Financing product recommendation method

A recommendation method and product technology, applied in the field of financial investment, can solve problems such as inaccuracy, uncertainty, and robo-advisors cannot meet investment needs, and achieve the effect of large investment returns

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0045] The above and other technical features and advantages of the present invention will be clearly and completely described below in conjunction with the accompanying drawings. Apparently, the described embodiments are only some of the embodiments of the present invention, not all of them.

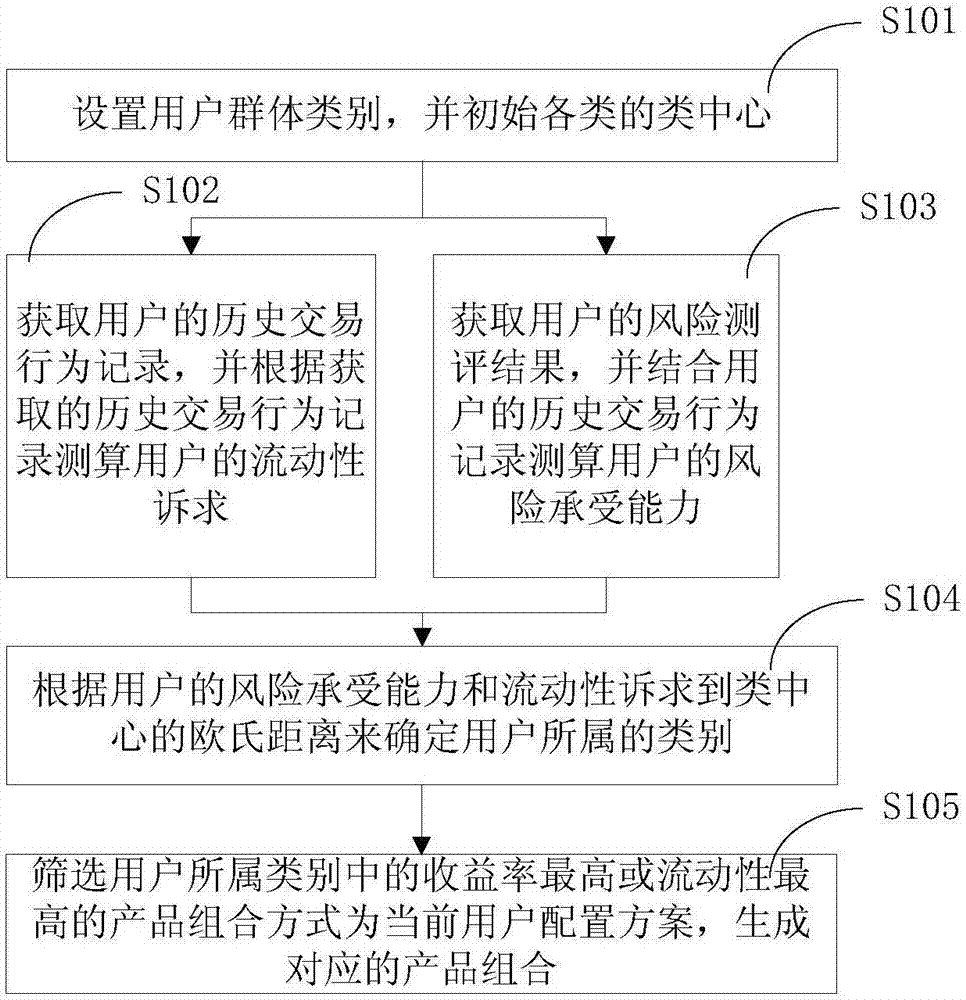

[0046] Such as figure 1 As shown, a financial product recommendation method includes the following steps:

[0047] S101: Set user group categories, and initialize various category centers;

[0048] S102: Obtain the user's historical transaction behavior records, and calculate the user's liquidity demands according to the obtained historical transaction behavior records;

[0049] S103: Obtain the user's risk assessment results, and combine the user's historical transaction behavior records to measure the user's risk tolerance. In this embodiment, the risk assessment results are obtained in the form of questionnaires;

[0050] S104: Determine the category to which the user belongs accor...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com