Credit rating adjusting method based on credit rating and loss given default matching

A technology of loss given default and credit rating, which is applied in data processing applications, instruments, finance, etc., and can solve problems such as low loss given default and unsatisfactory credit ratings

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

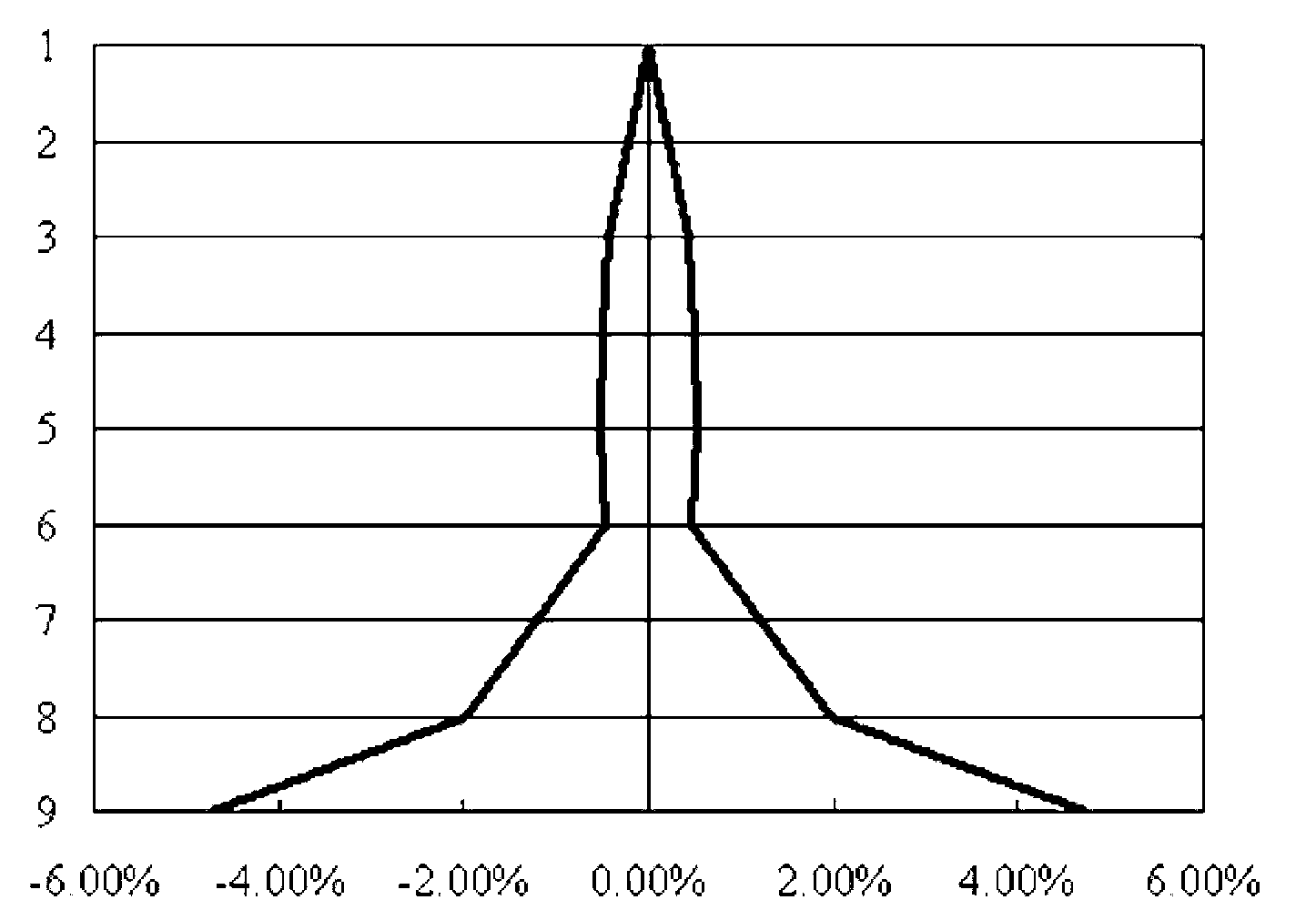

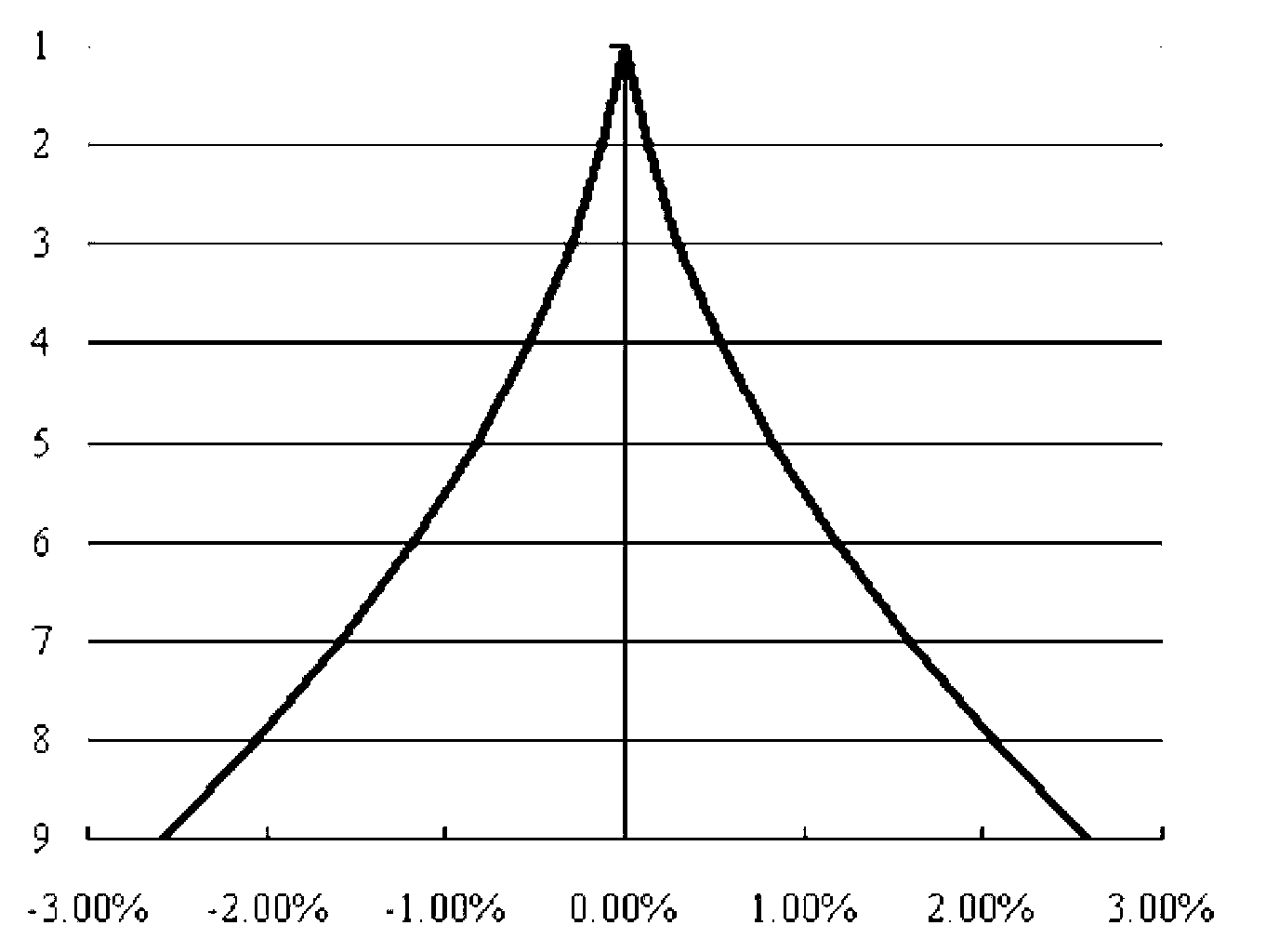

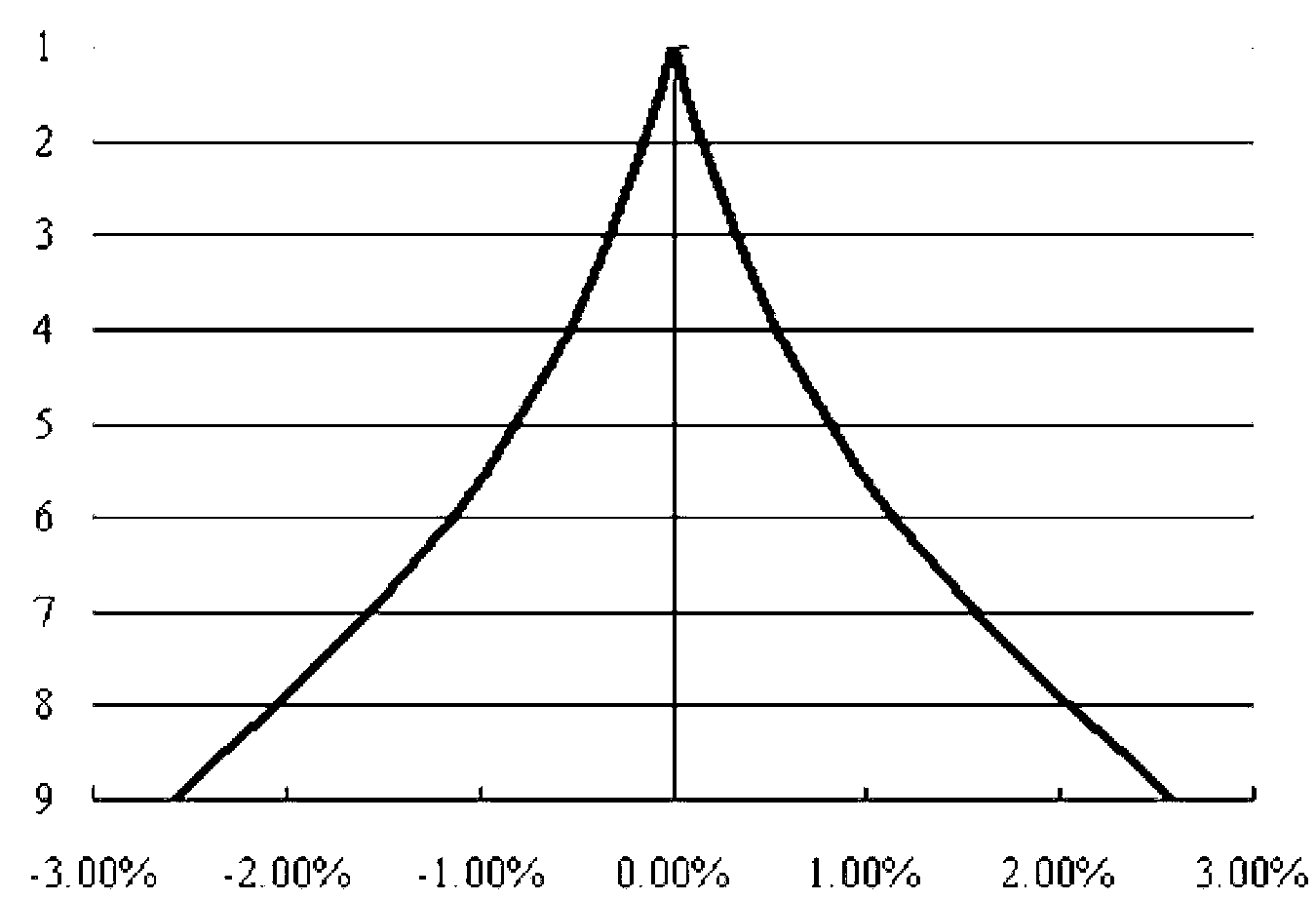

[0036] The invention discloses a work flow of a credit rating adjustment method based on the matching of credit rating and default loss rate.

[0037]The credit rating adjustment method of the present invention is composed of a credit rating division function, a setting adjustment standard function, and a credit rating adjustment function. Through a credit rating adjustment algorithm based on matching credit ratings and default loss rates, credit rating adjustments are realized. Each function includes:

[0038] (1) Credit rating division function: set division parameters and output division results.

[0039] (2) Set adjustment standard function: set adjustment parameters, output adjustment standard. Among them, the adjustment standard is realized according to the credit rating adjustment algorithm based on the matching of credit rating and default loss rate.

[0040] (3) Credit rating adjustment function: data analysis, credit rating adjustment.

[0041] Such as figure 1 S...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com