Bimodal computer-based system for selling financial products

a computer-based system and financial product technology, applied in the field of bimodal computer-based system for selling financial products, can solve the problems of complex decision to purchase a financial product or service, failure to allow consumers of financial products and services to compile research, and difficult to assess consumer needs and consumer education, and achieve the effect of enhancing transparency and facilitating consumer education

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Benefits of technology

Problems solved by technology

Method used

Image

Examples

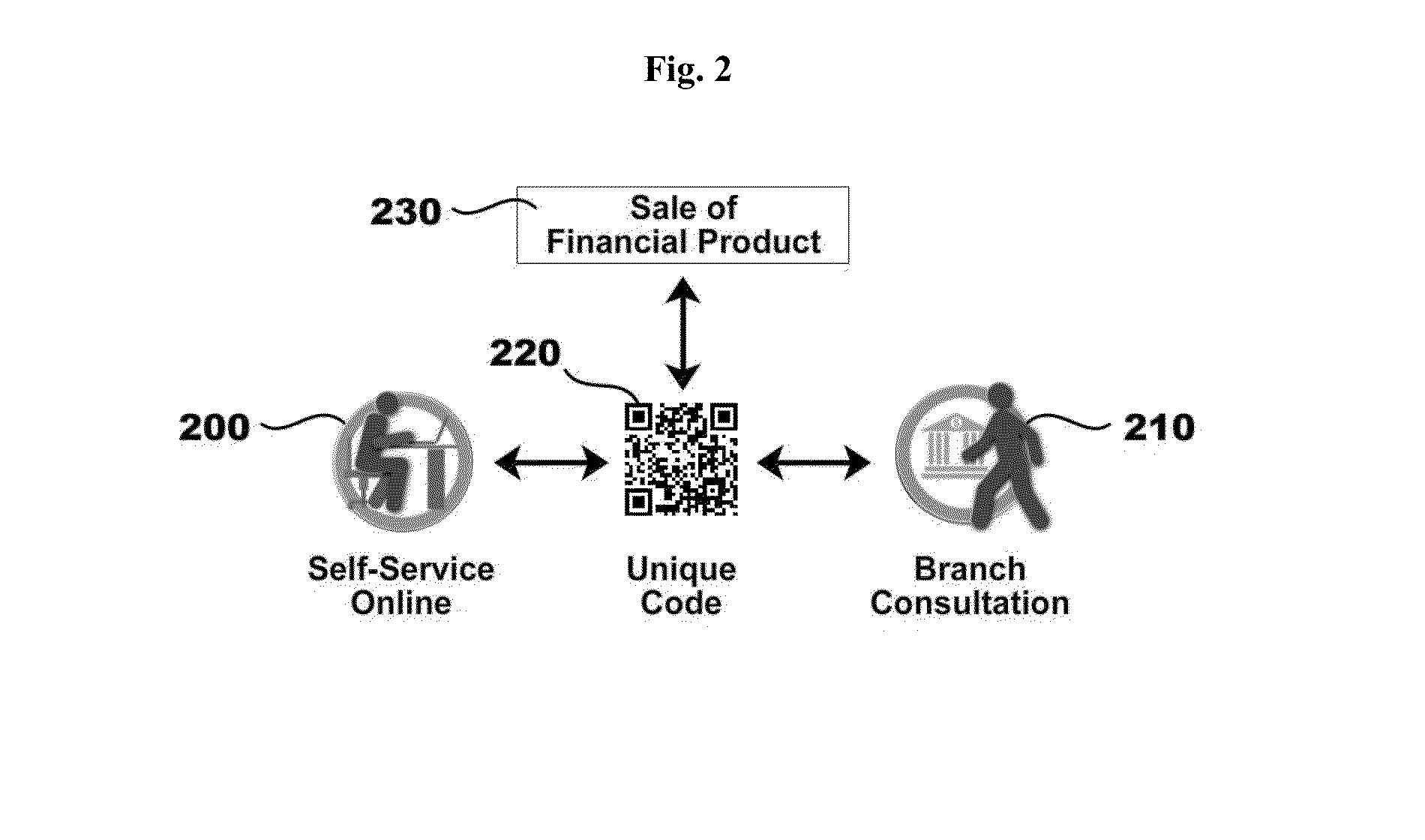

example 1

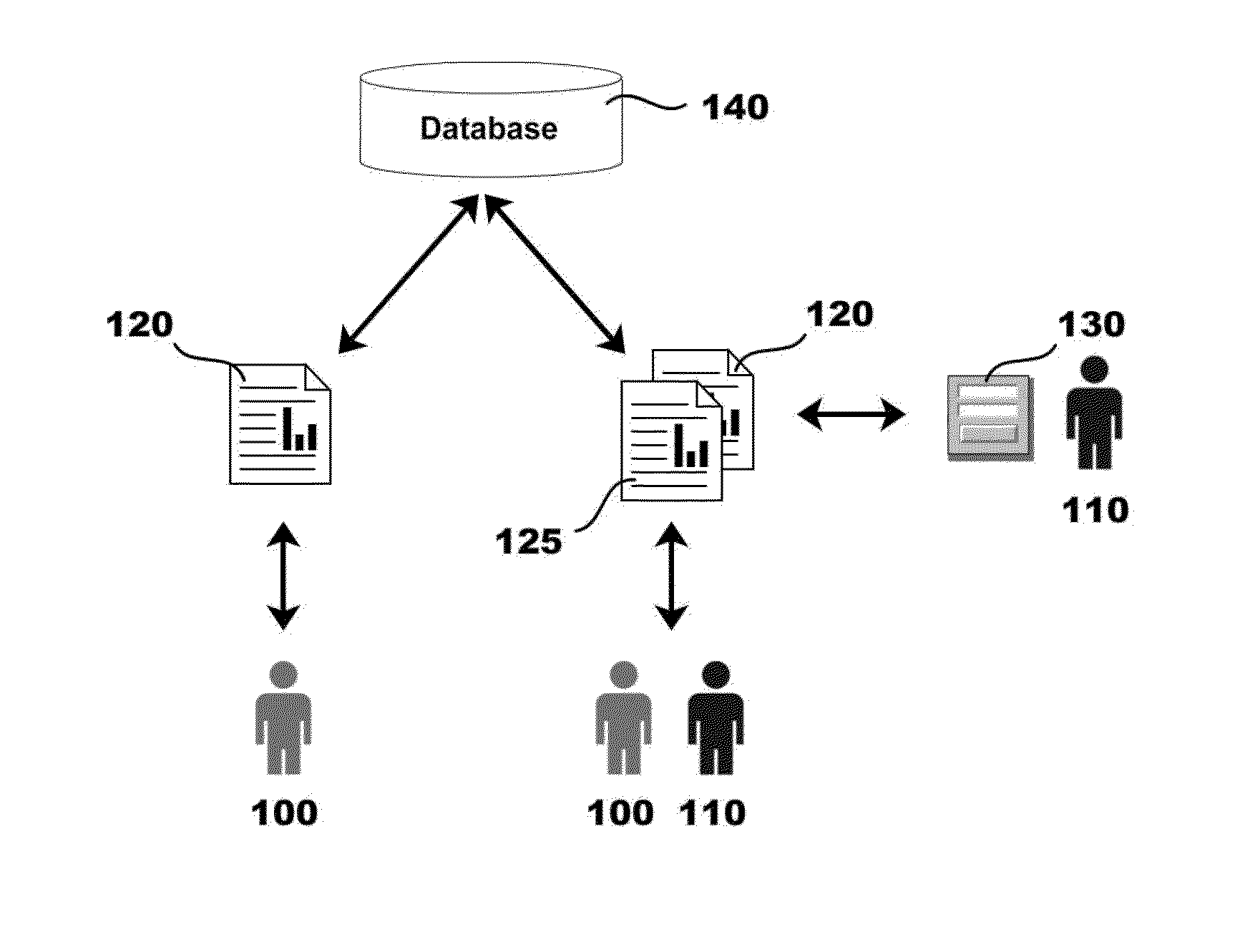

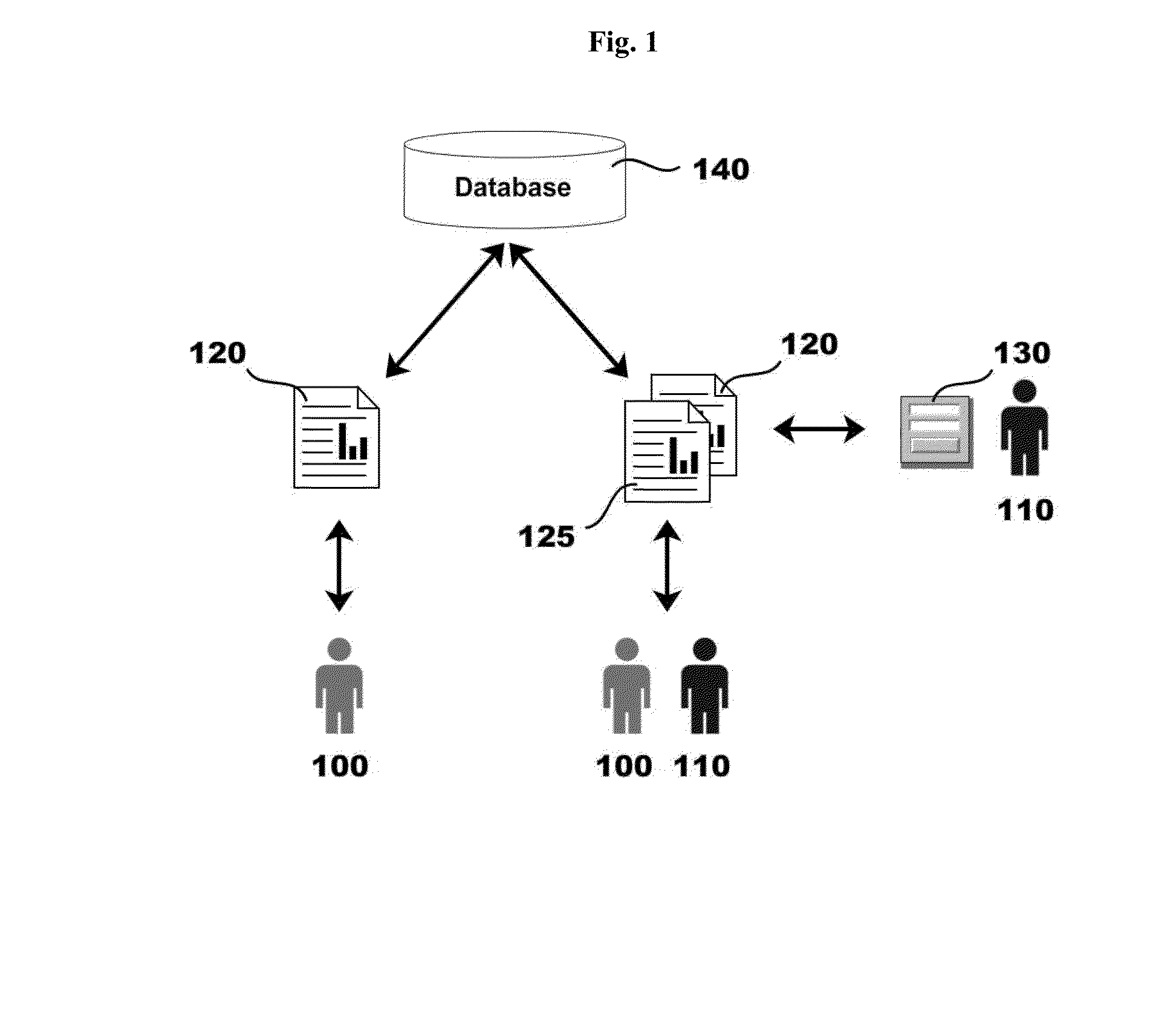

Persistence from Self-Service Mode to Collaboration Mode

[0096]A consumer would like to learn about options to refinance her home. She uses her laptop computer to access a web application providing financial product education, research, and recommendation tools. The web application is a bimodal application, operating in a consumer self-service mode. After reading and learning about mortgage refinancing in general, she participates in a question-based needs assessment dialog to help her identify, compare, and review appropriate financial products. The consumer has lingering questions and would like the advice of a financial professional to assist her in making a decision. She clicks a button within the web application indicating she would like to meet with a financial services representative to review and discuss her research to date.

[0097]The web application presents a tool for the consumer to locate the nearest branch location and further offers tools to schedule an appointment with...

example 2

Persistence from Collaboration Mode to Self-Service Mode

[0099]A consumer is interested in options for financing his child's future education. He visits his local bank branch location and discusses his needs with a financial service representative. She uses a web application providing financial product education, research, and recommendation tools to record his goals, calculate his financial needs, and collect his pertinent financial information. The web application is a bimodal application, operating in a consumer / financial service representative collaboration mode. The web application recommends several financial products that are matched to the consumer's situation. The financial services representative uses a sales overlay that extends the functionality of the financial product education, research, and recommendation tools to show the consumer the application for his preferred 529 plan. The consumer indicates that he would like to do more research on his own before making a final...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com