Method and apparatus for visually displaying high-frequency financial time sequence correlation

A financial time series and correlation technology, applied in finance, instrumentation, data processing applications, etc., can solve the problems that cannot reflect the change of correlation state time, the measurement method that does not reflect the probability of different correlation patterns, the lack of accuracy, etc. question

- Summary

- Abstract

- Description

- Claims

- Application Information

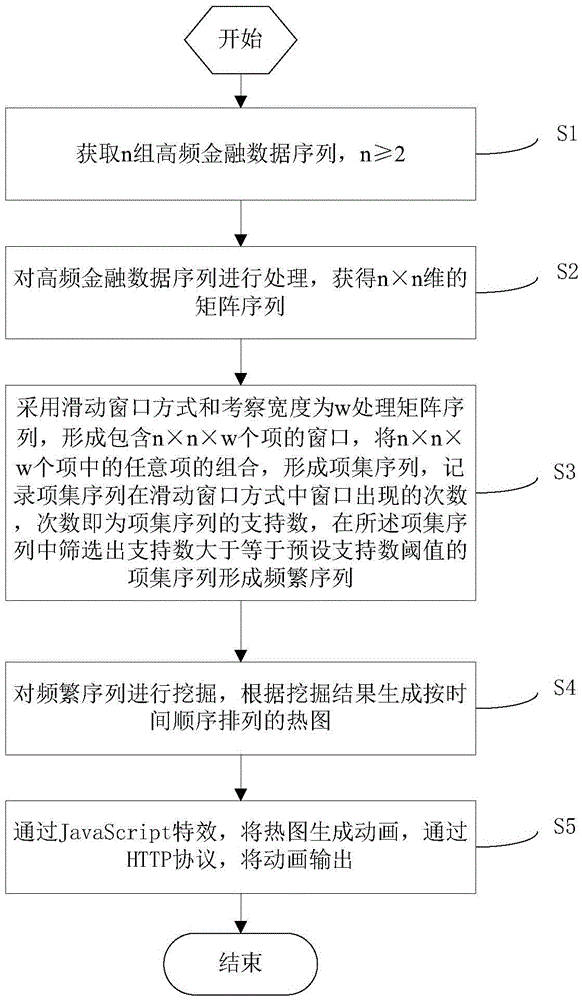

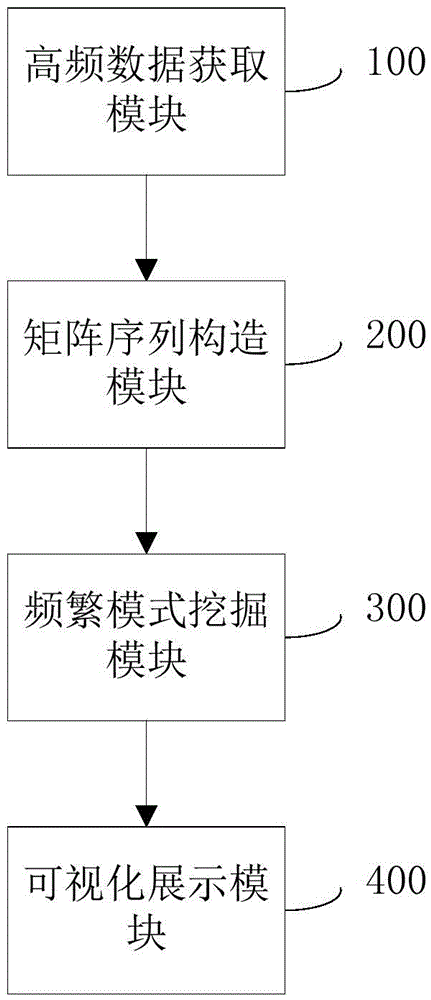

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 1

[0054] Taking the high-frequency stock price data as an example, considering the observed data in a certain time window, the logarithmic rate of return is:

[0055] R t =ln(P t )-ln(P t-1 )

[0056] where P t is the closing price on day t, and the rate of return R t is a time series.

[0057] Collect two yield time series x and y;

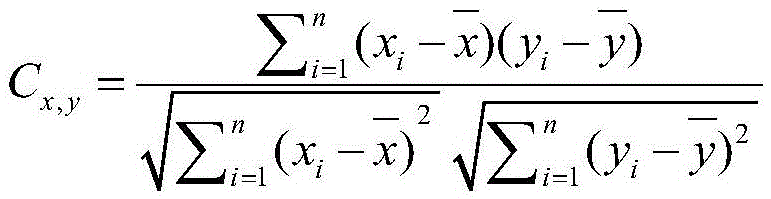

[0058] The Pearson correlation coefficient of x and y is:

[0059] C x , y = Σ i = 1 n ( x i - x ‾ ) ( y i - ...

Embodiment 2

[0068] Collect two discrete logarithmic return sequences x and y over a time period;

[0069] The states of x and y at time n are denoted as i n and j n ; Due to the short memory of the logarithmic return sequence, for simplicity, assuming that the sequence is a first-order Markov process, the transfer entropy from x to y is:

[0070] TE x → y = Σ i n + 1 , i n , j n p ( i n + 1 , i n , j n ...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com