As such, there is currently no meaningful mechanism to arrive at an accurate market price that reflects the quality of each entity and of the underlying debt instruments, which results in significant pricing inefficiencies.

Over the past decade, the size of the CDS market has multiplied many-fold, resulting in tens of trillions of dollars of notional value for which, however, there is no reserve.

To complicate matters, buyers of the CDS instruments cannot accurately quantify their risk exposure when purchasing such instruments, nor is there any structured, repeatable process to accurately discover and validate pricing at the time of purchase or resale.

These same risks plague the insurance companies providing the coverage to the underwriter.

For example, while certain pricing models are assumed to account for the risks associated with the reference entity (which is not always the case, as explained below), such models do not account for the default risk or the increased risk of failure of the underwriter itself, or those of its insurance companies.

Thus, the buyer of the CDS may have accounted for the risk associated with the reference entity, but remains largely exposed to risks associated with the underwriter.

Any catastrophic failure of an underwriter, accordingly, will necessarily result in a loss of coverage for bonds held by the numerous entities who bought the CDS assets as a hedge against the bonds, forcing the sale of the bonds at pennies on the dollar.

Furthermore, hedge funds that bought the CDS assets as a potential hedge to protect their position in the underlying security, or as pure speculation, will not be able to collect the gains, causing a panic in the market with disastrous consequences.

Such effects are multiplied when the insurer of the risks does not have sufficient reserves, and / or the risks were not appropriately distributed among other insurance companies, resulting in further market collapse.

Another issue that limits the ability of the parties to accurately price CDS assets is so-called “digital discontinuity”, and the differences in resolutions of the debt ratings at various stages of the process.

The bond buyer may now purchase a CDS based on the debt, but because the actual quality and risk of the debt pool has been manipulated, the determining of a true price for the CDS is difficult.

Even the existing reference entity default risk pricing models suffer from serious limitations.

Although they tend to work well while the borrower and the issuer of the bond are one and the same entity, the accuracy is significantly reduced when that is not the case.

For example:there may be a significant difference between the debt ratings at the origin of the bond in contrast to the current rating of the bond issued by a third party using that debt;the impact on the overall debt quality is not well understood when asset pools are created for the purposes of securitization and it is very difficult to maintain a consistent quality throughout the pool;the process of creating the debt pools is not done concurrently with the issuance of the debt, and therefore is sub-optimal;there is no easy way to update the pool rating if there is deterioration or enhancements in the end borrower's credit quality; andthere is no easy way to continuously monitor the quality of the key characteristics of the pool, thus making any meaningful risk monitoring and risk control difficult.

Thus, there are the following primary factors impacting the CDS price and preventing its accurate measurement:1. Lack of identification, quantification and monitoring of risks for each of the participants, and requisite controls to manage such risk within an acceptable range;2. lack of identification and quantification of cross connectivity parameters among the participants and the magnitude of risk each one imparts to its other connected participants;3. ill-defined means to reflect the collective impact of such risks on the final CDS price; and4. inability to update the price appropriately as the debt quality of the end borrowers evolve as a function of time.

Taken together, these conditions result in a wide range of disparity in determining a true CDS price, and a lack of any meaningful visibility or control on the part of the market participants to manage the risk, further jeopardizing the validity of the price.

This becomes even more troublesome when an existing CDS owner wants to sell a CDS that is “in-the-money”—i.e., it has appreciated in value.

Such a purchase requires a cash outlay on the part of the new buyer, thus adding another parameter to the already complicated existing pricing process.

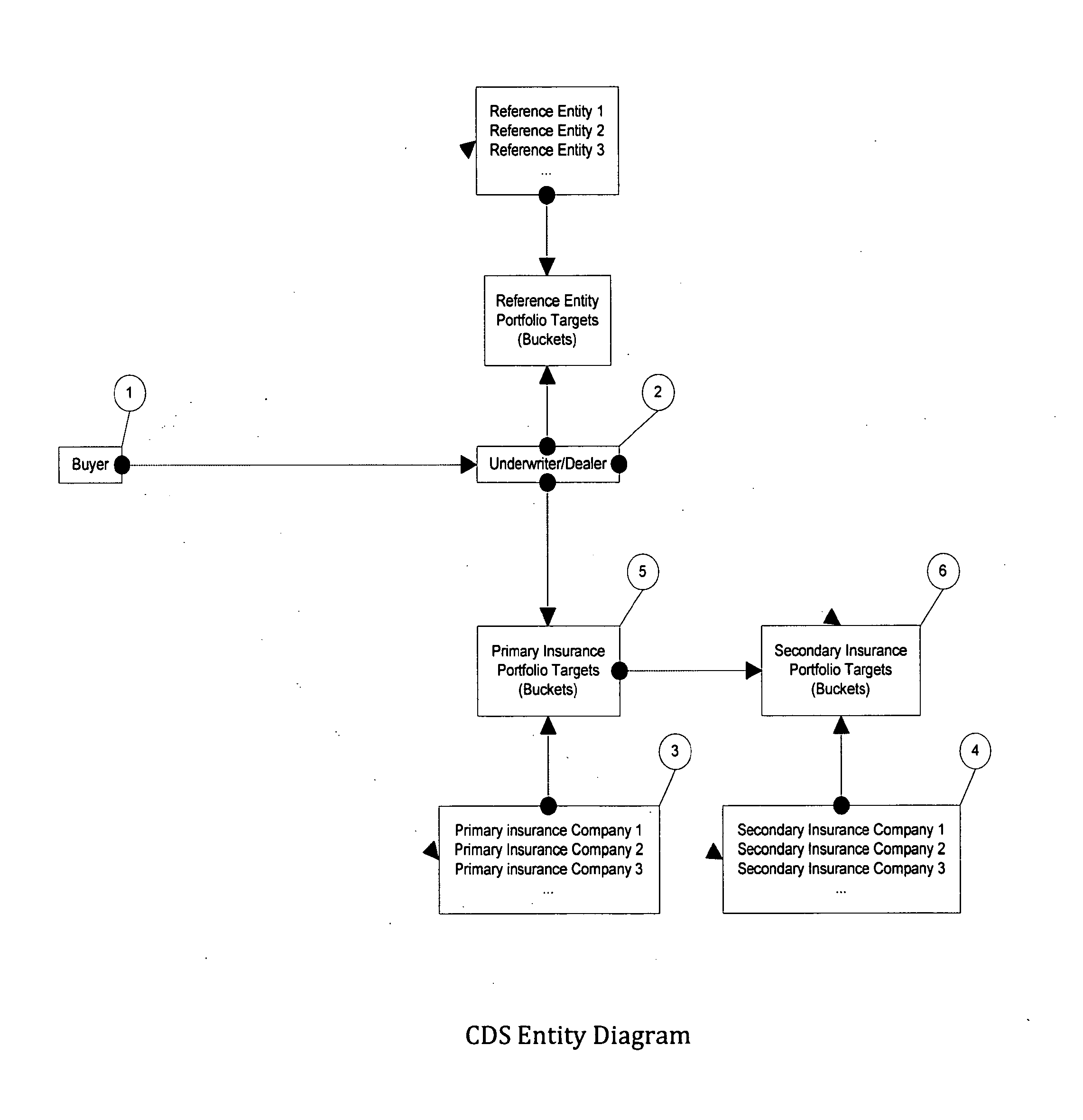

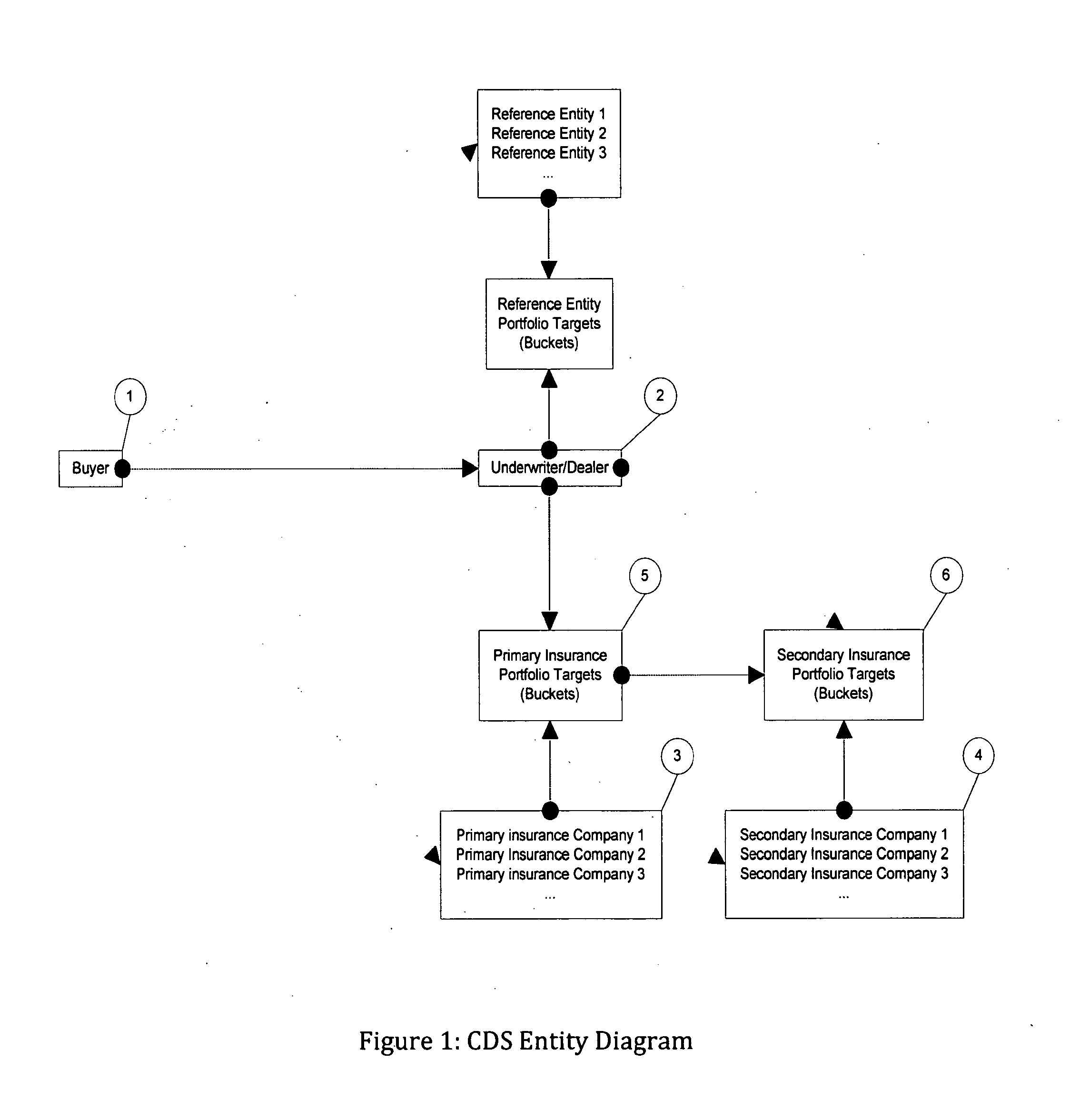

The makeup of a portfolio of CDS instruments, furthermore, has an impact on the counterparty default risk.

For example, each reference entity has a corresponding rating, typically provided by one of the rating agencies; but there is no comprehensive view into the underlying components of the portfolio which is necessary to understand the risks associated with the non-reference entities.

If most of the portfolio entities are rated ‘CCC’, the risk of reference entities default is high, and therefore the risk contribution of the underwriter and any support insurance companies becomes progressively larger.

Another fact is that most CDSs have a nominal maturity duration of five years, but once purchased, the duration diminishes over time, impacting its value.

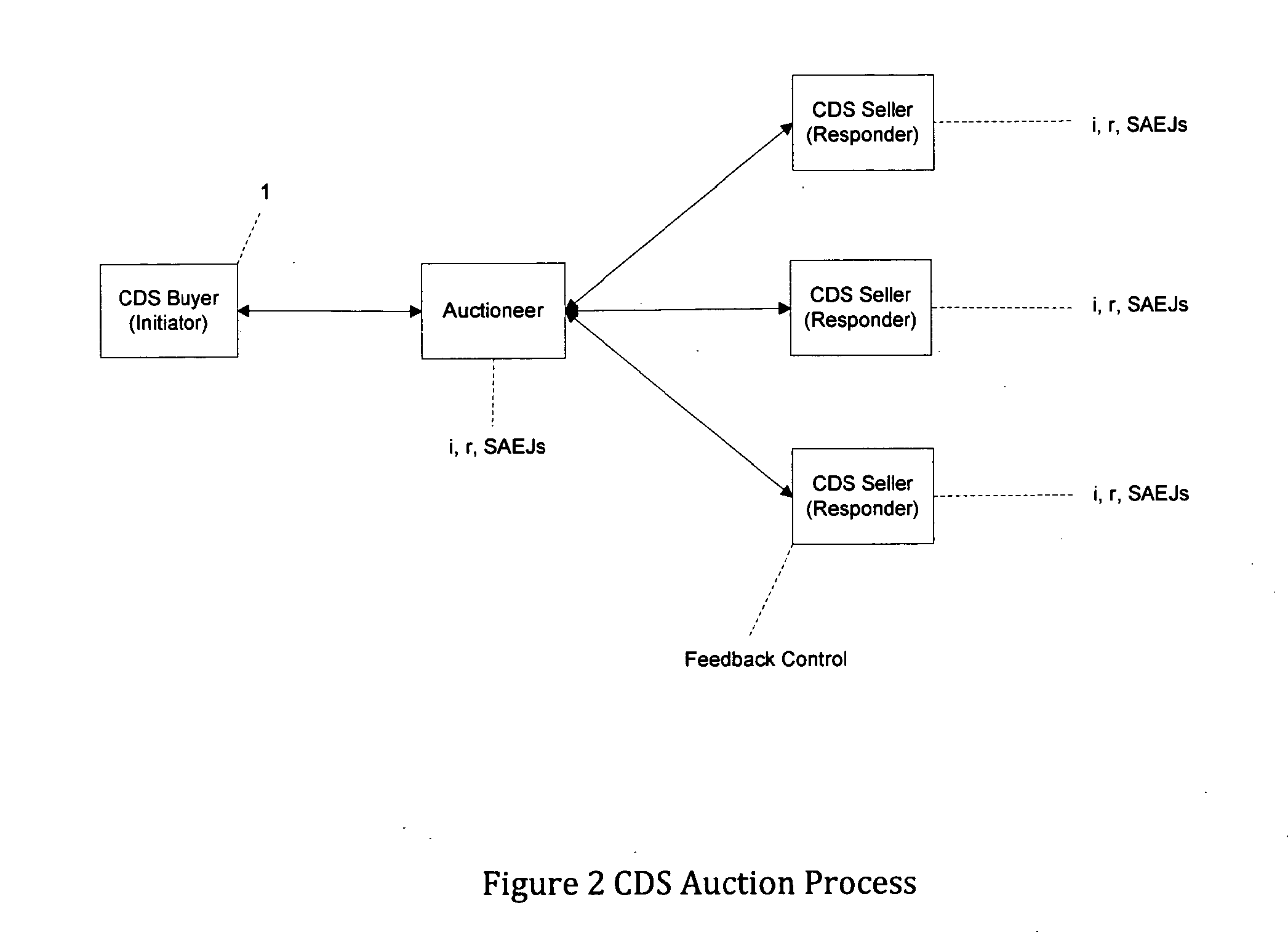

Currently, the process to distribute the purchases to various industry segments or to the segments where large net gains are anticipated is largely manual.

As these bonds start to default, the payments become due and the burden on the counterparty may become too big to handle, resulting in its default.

A manual approach to analyze this risk is not timely, is highly inefficient and is a drain on the resources.

If newer CDSs are more expensive (as the sector comes under significant adverse pressure), the burden to replace the existing CDSs increases.

There are also a number of factors contributing to the overall risk profile of the insurers of the CDS pools, which are not reflected in conventional CDS pricing models.

Login to View More

Login to View More  Login to View More

Login to View More