Patents

Literature

2274 results about "Risk Control" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

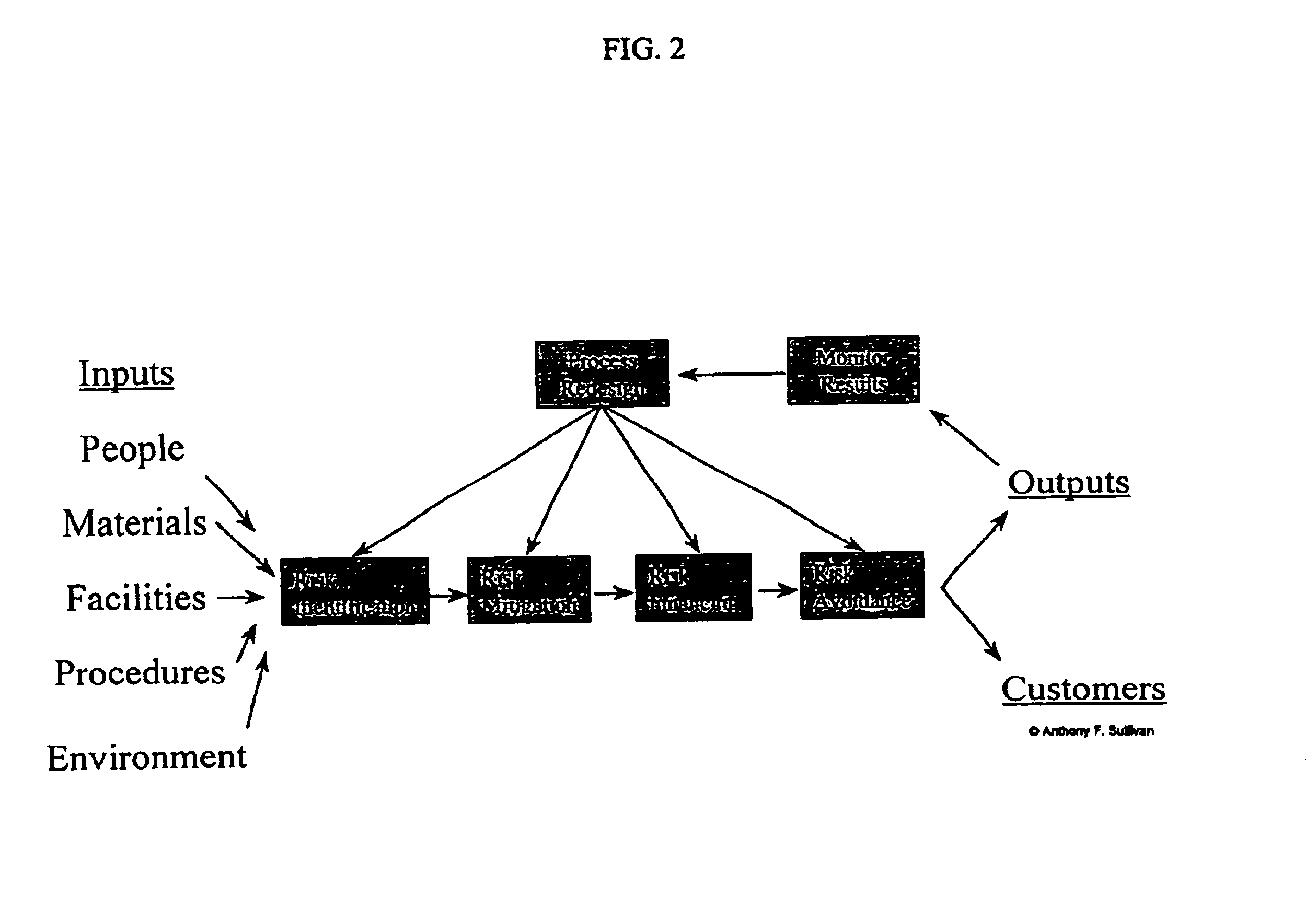

Risk Control refers to techniques that reduce the frequency or severity of losses. This technique for managing risk is something that is seen in the community every day by risk managers and the insureds that they work to protect from risk. Risk managers usually use this technique and risk financing for treating each type of loss exposures. Some of the major risk control techniques include avoidance, loss prevention, and loss reduction.

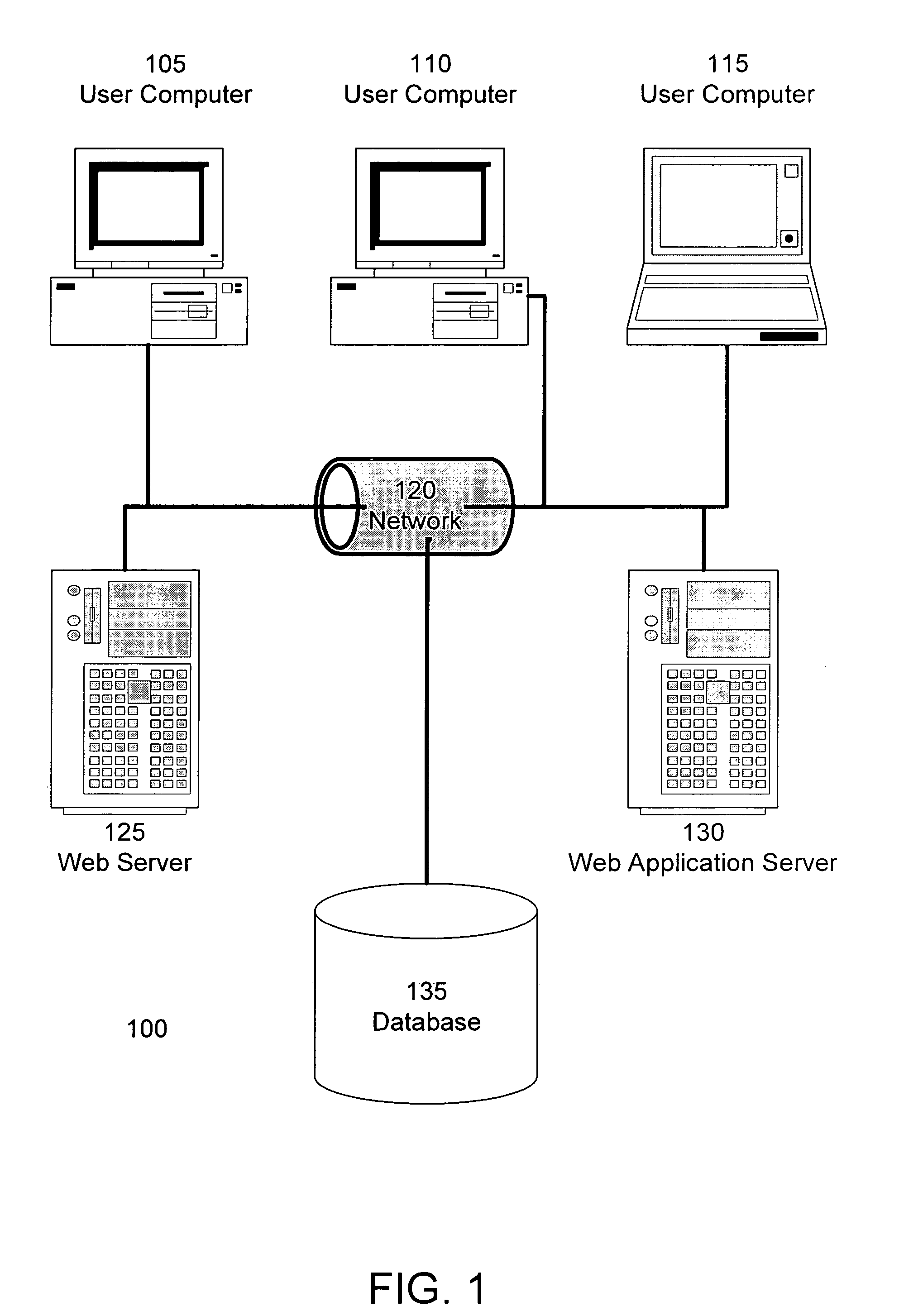

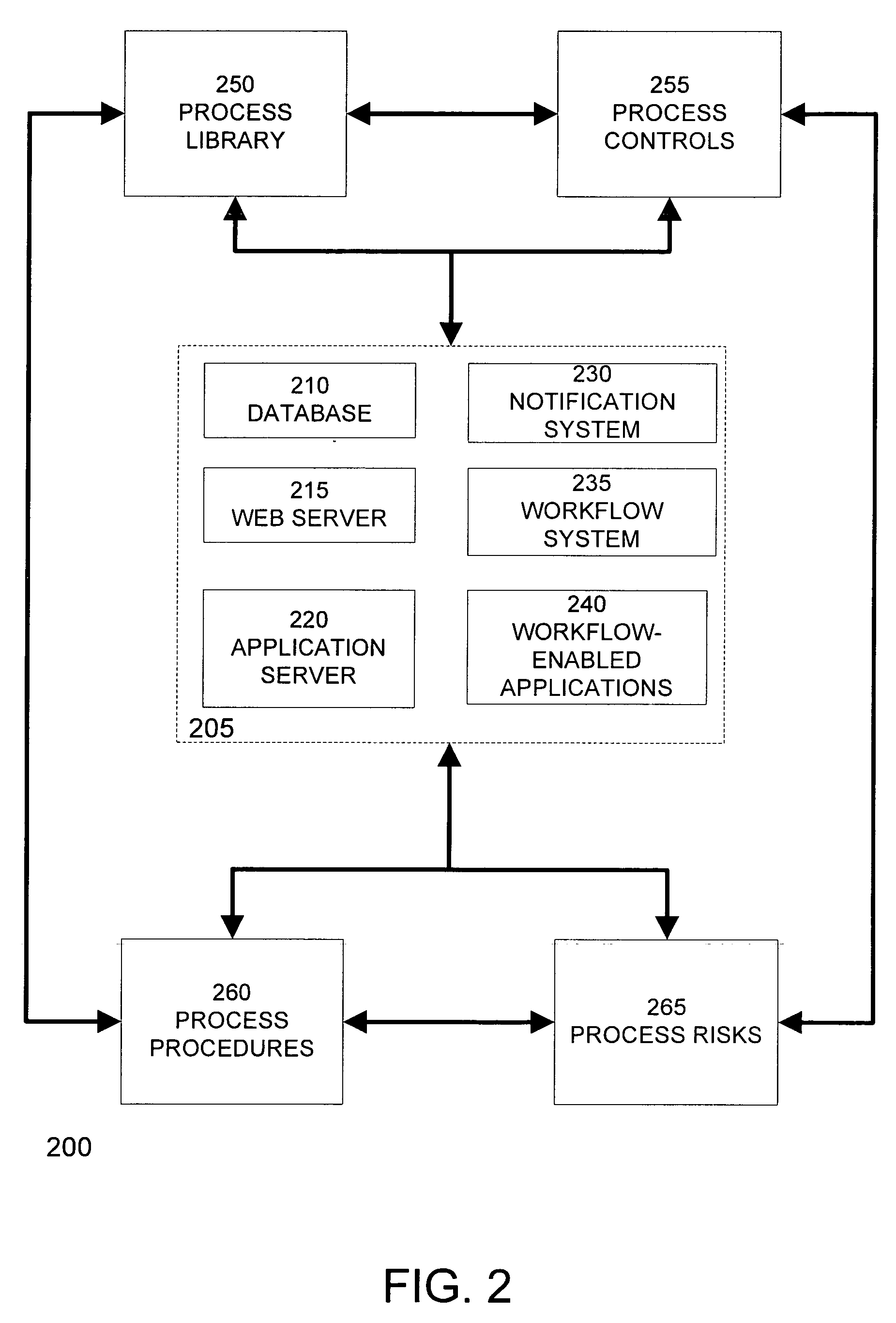

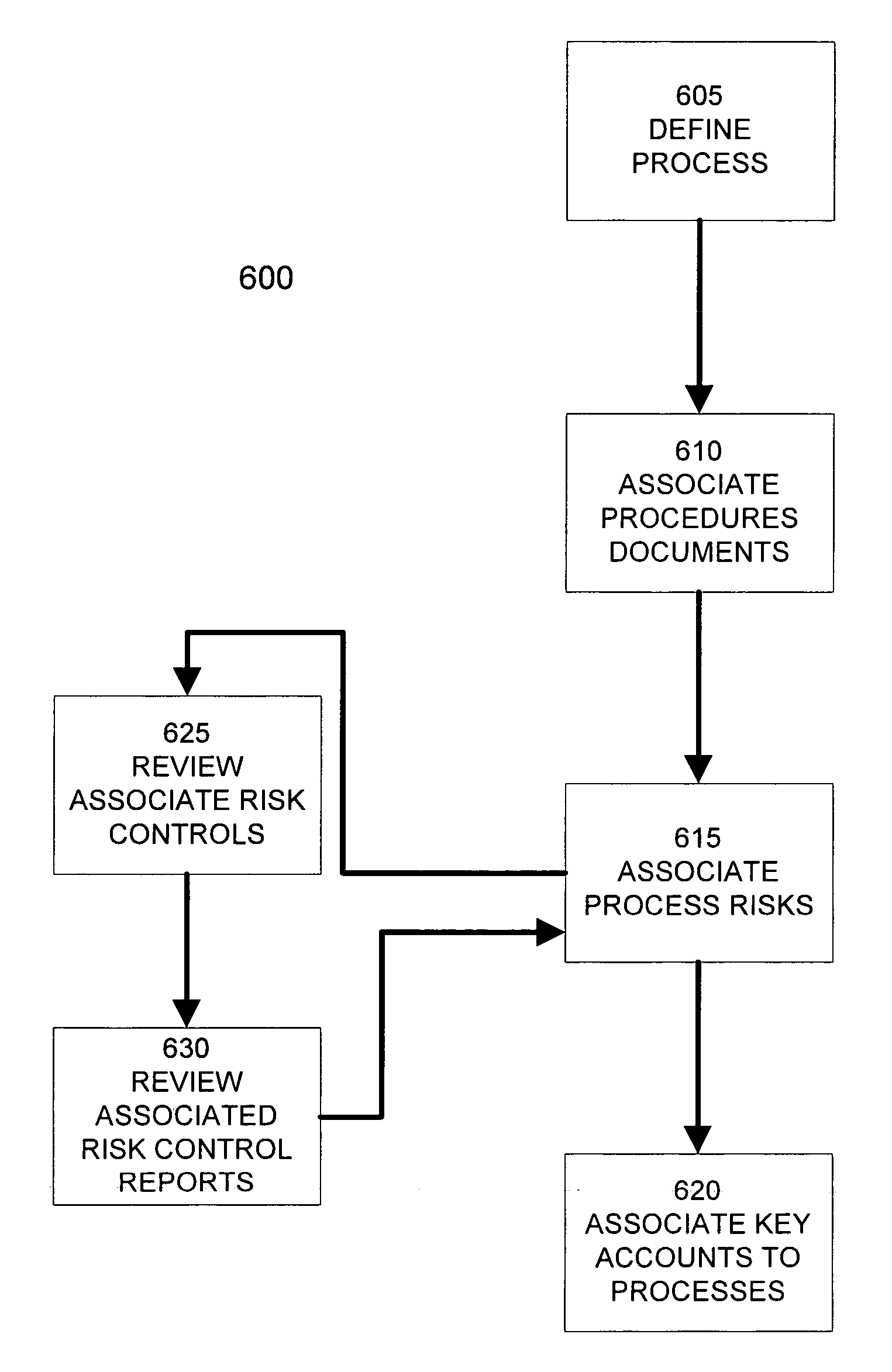

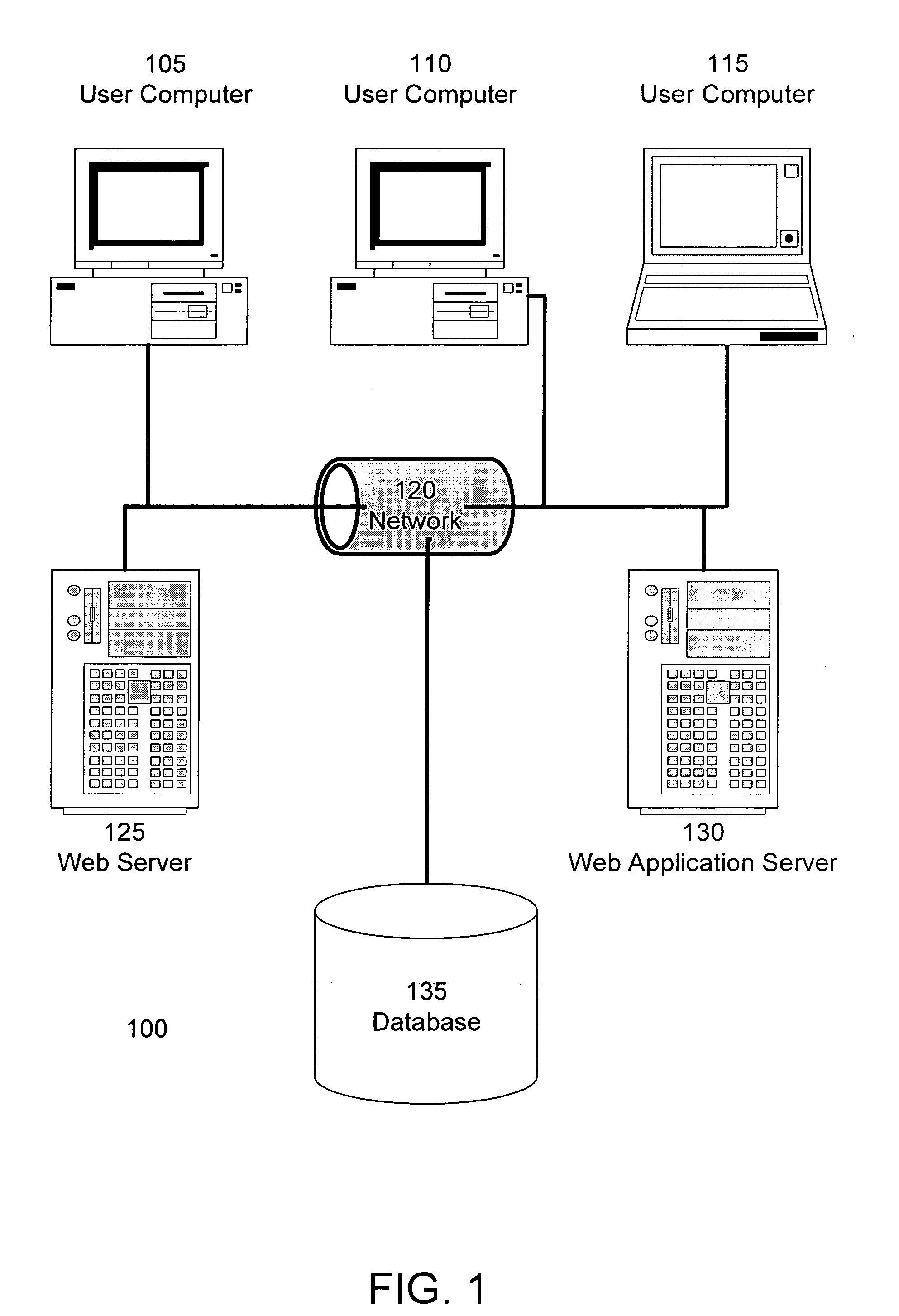

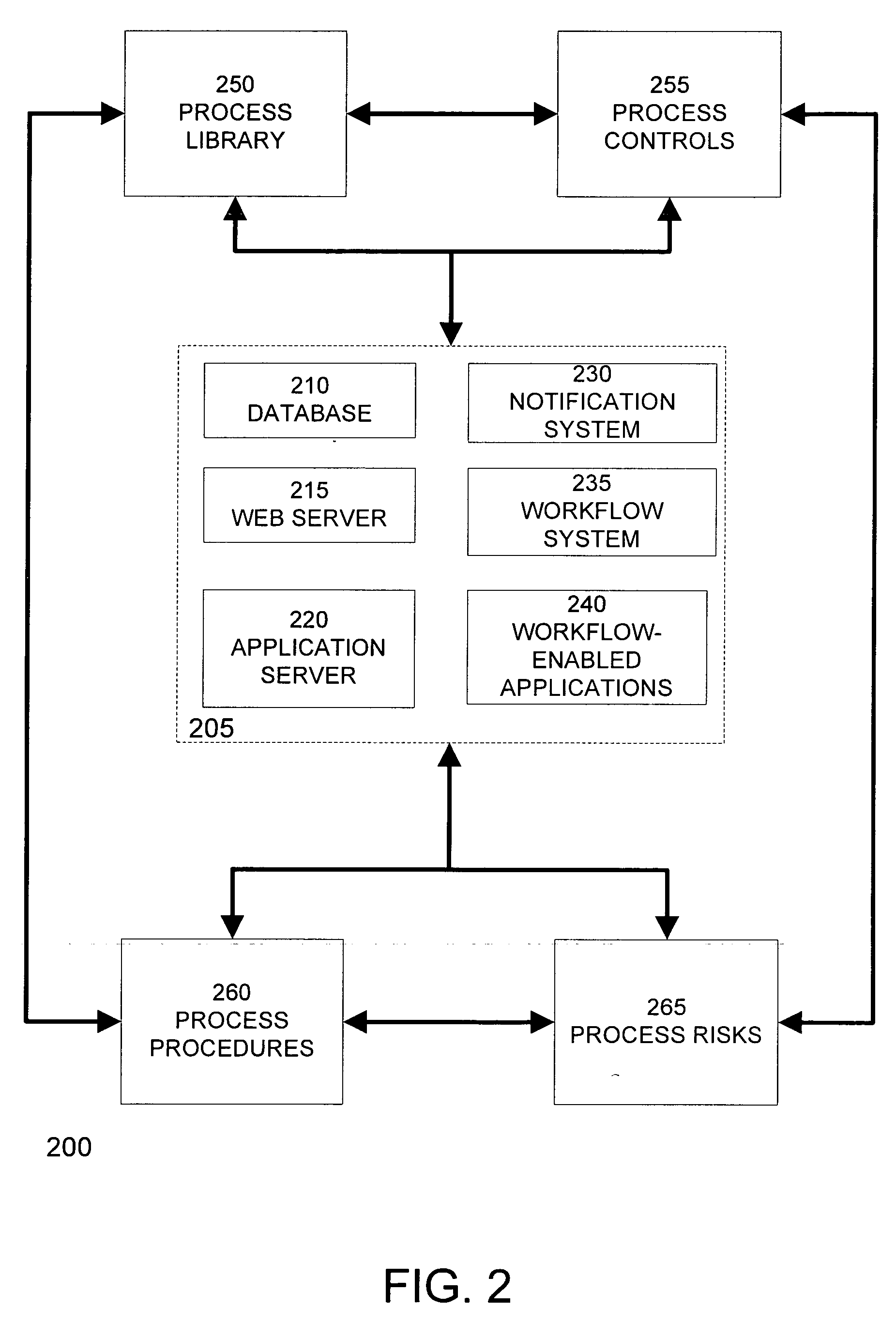

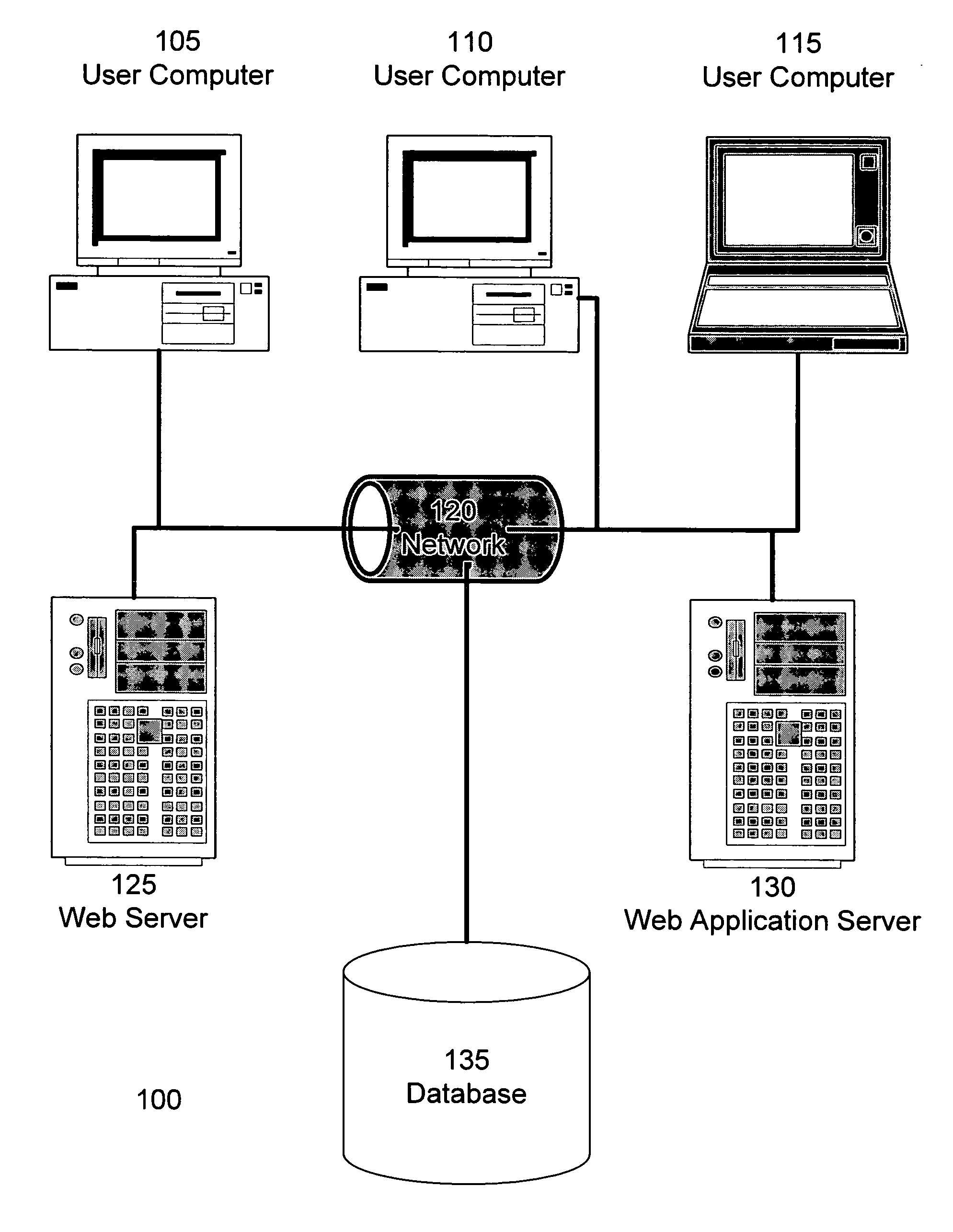

Internal audit operations for Sarbanes Oxley compliance

A system provides audit opinions on an enterprise's organizations, processes, risks, and risk controls. The system first evaluates the enterprise's set of risk controls. The audit opinions of the set of risk controls are used to evaluate the set of risks associated with the set of risk controls. The audit opinions of the set of risks and of the set of risk controls are in turn used to evaluate the set of processes associated with the set of risks. Finally, all of these audit opinions are used to evaluate the set of organizations associated with the set of processes. The system streamlines the evaluation of risk by determining suggested audit opinions. Suggested audit opinions for a given item can be determined from audit opinions previously determined and associated with the given item. Rules can be defined for a given item to specify how to determine the suggested audit result.

Owner:ORACLE INT CORP

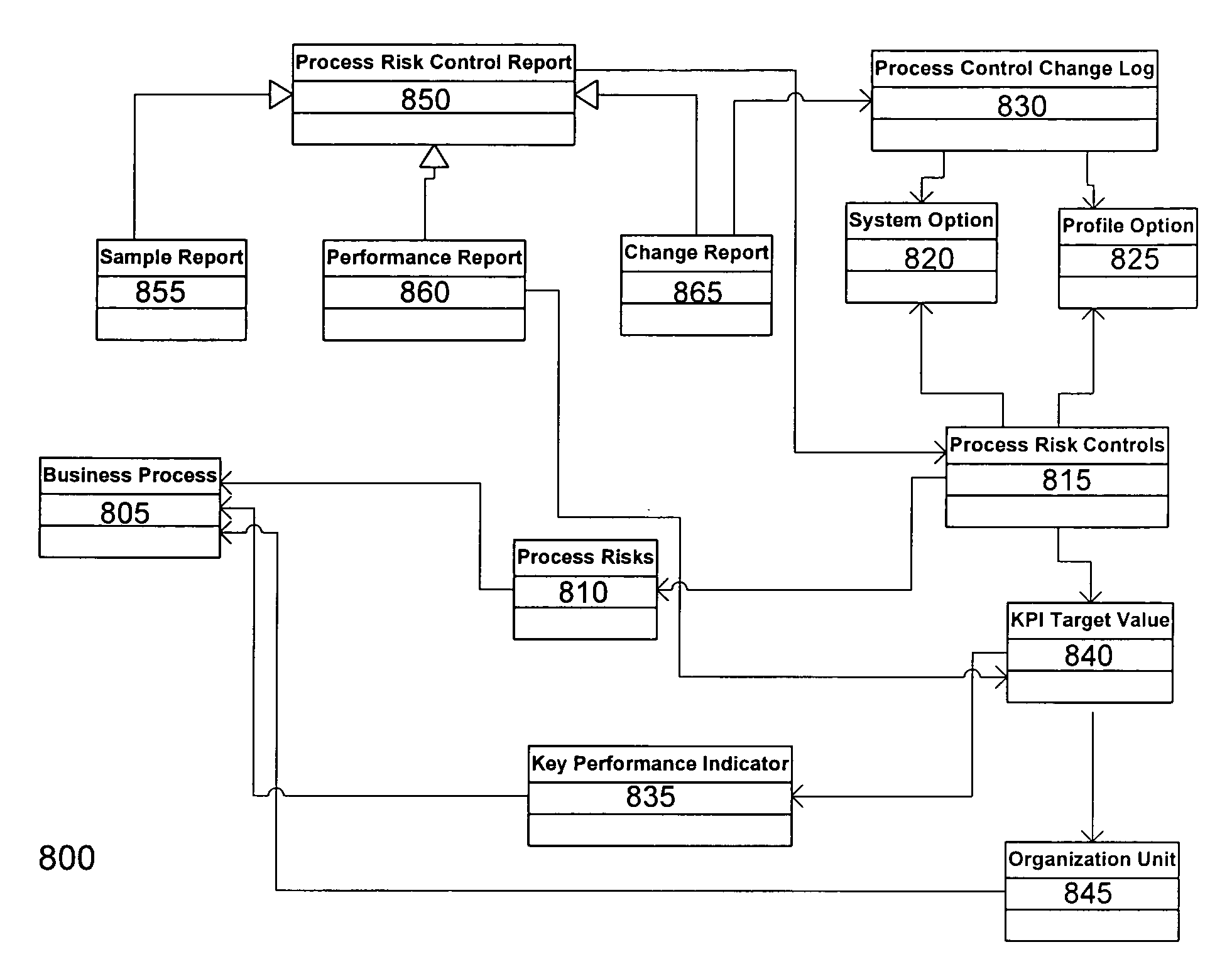

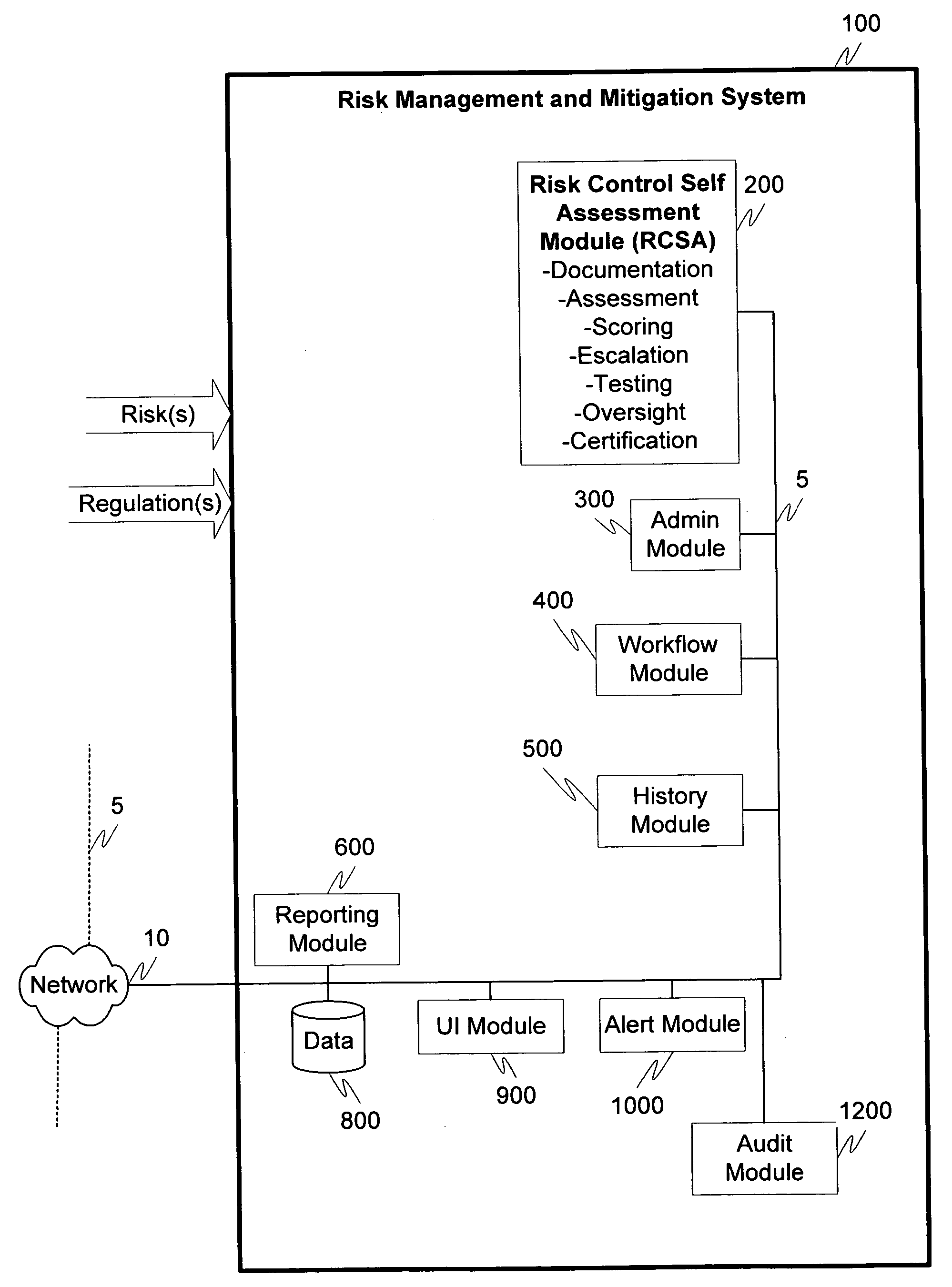

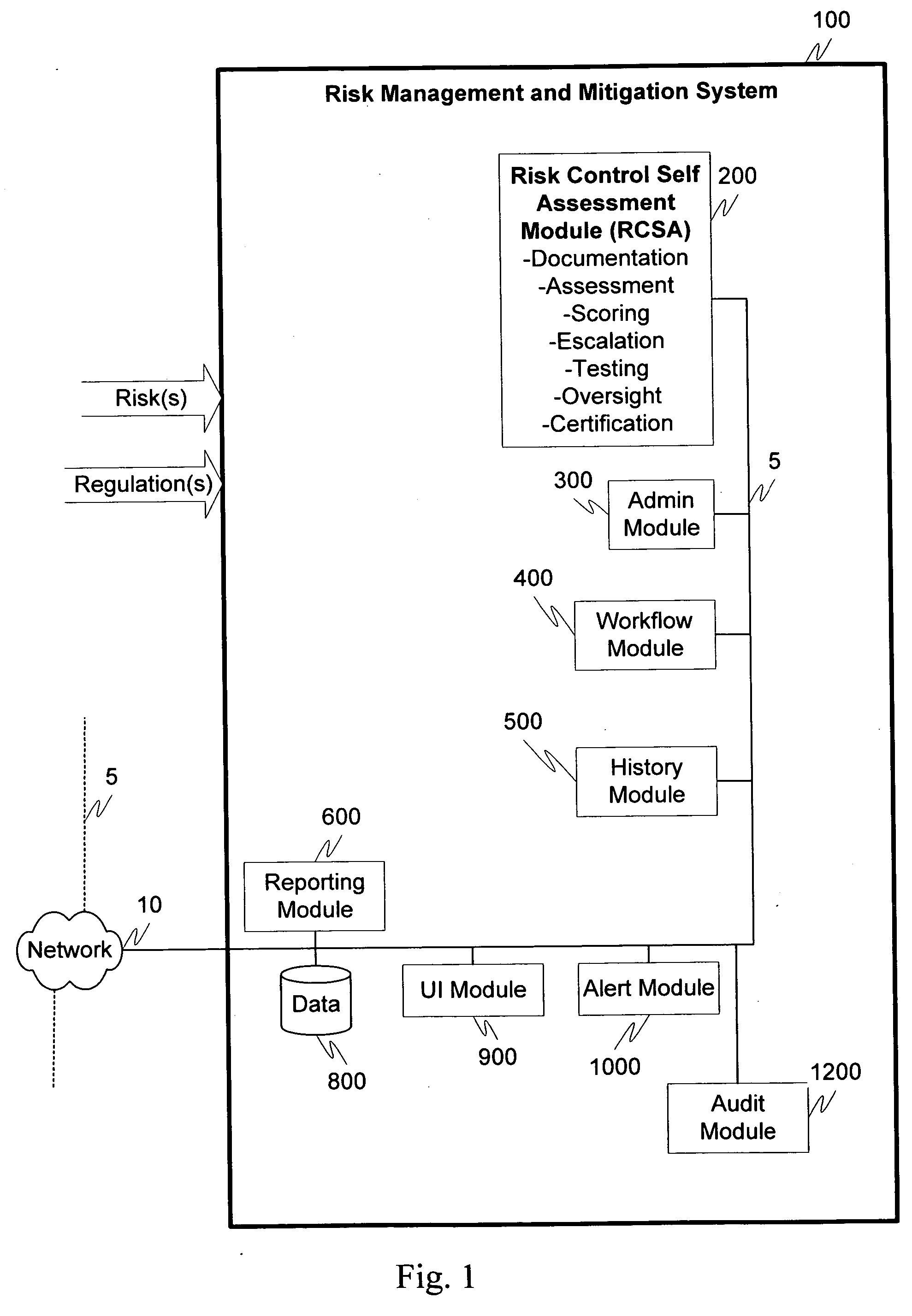

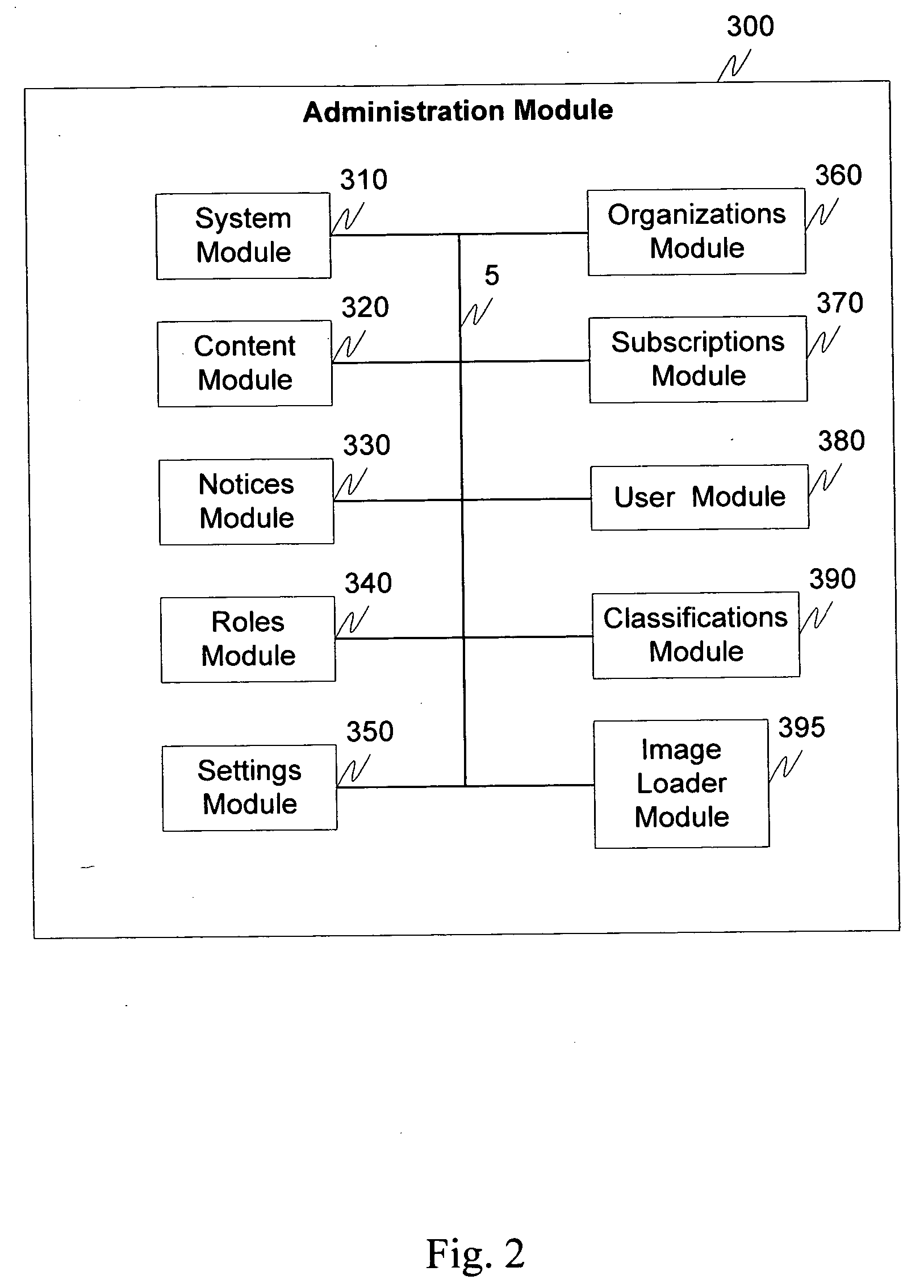

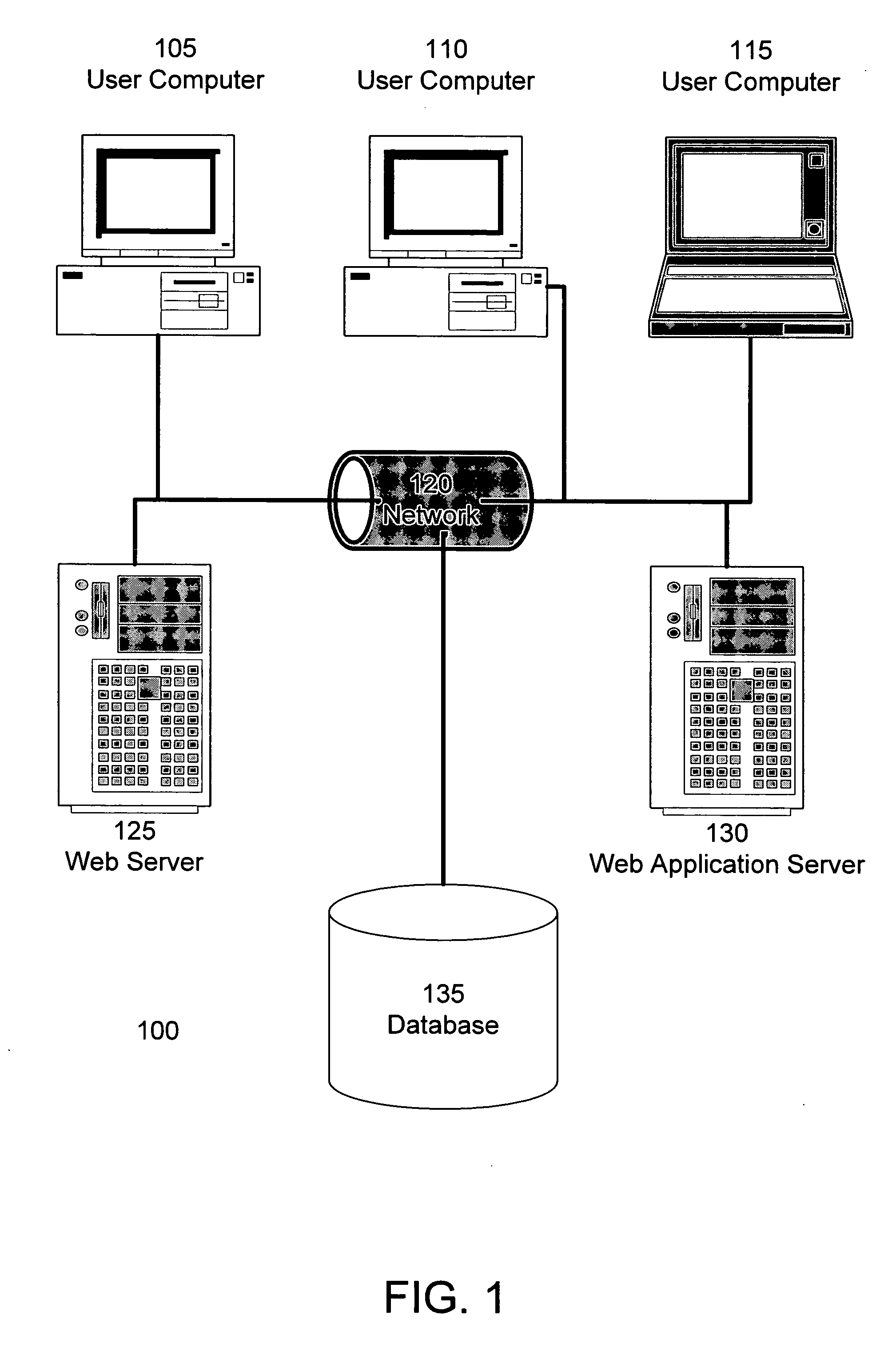

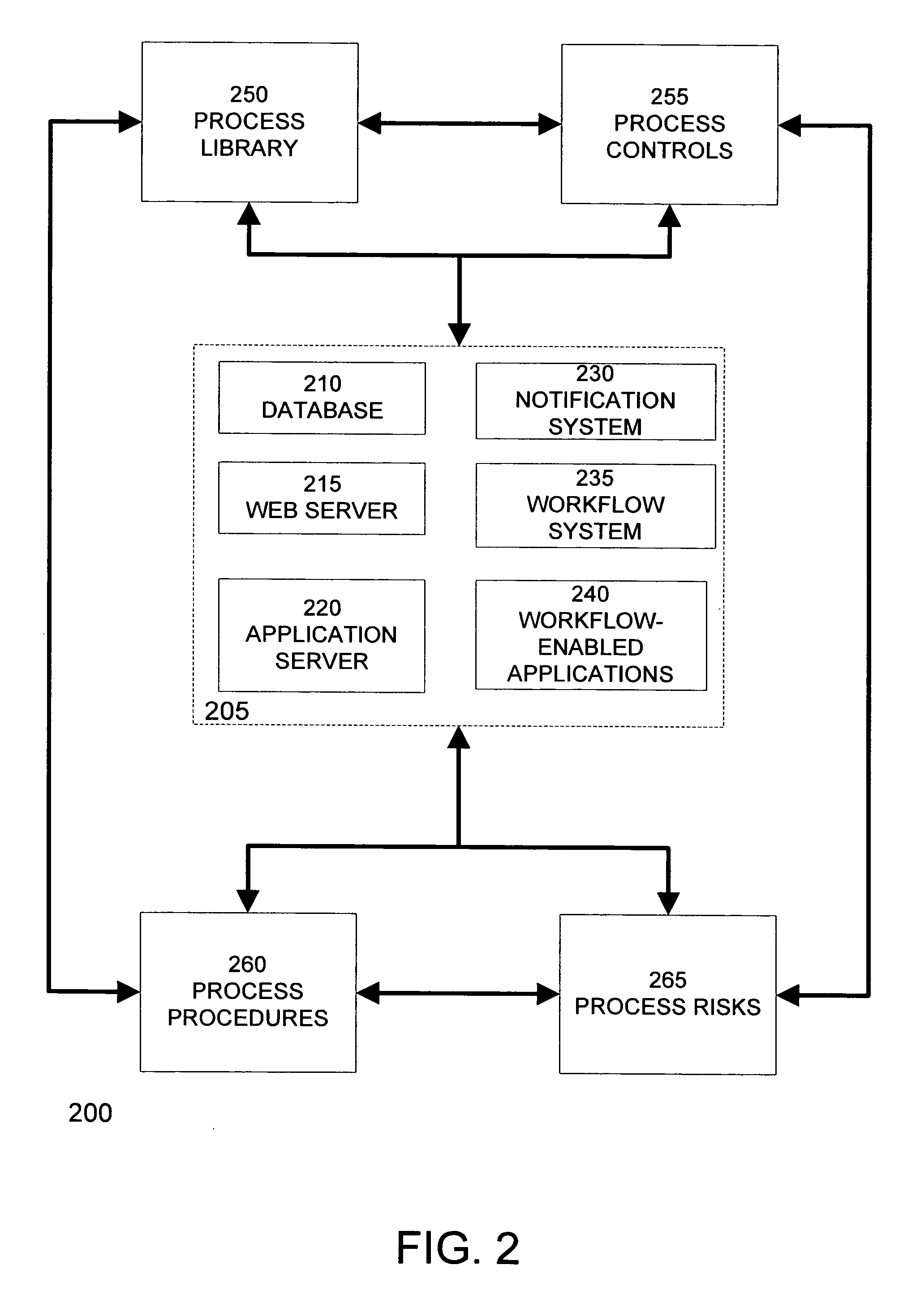

Risk mitigation management

InactiveUS20050197952A1Quicker and easy role-up certification reportReduce lossesFinanceSpecial data processing applicationsRisk exposureVisibility

Risk mitigation and management is provided through an executive management application for the active management of operational risks, derived from exposure to factors that threaten strategic objectives related to operations, strategy, regulation and recording priorities. This system is based on a architecture that automates the Committee Of Sponsoring Organizations (COSO) framework for enterprise risk management, using the objective, risk, control and actions (ORCA) methodology to actively manage risk at the business unit level. This business process and feedback mechanism actively isolates, evaluates and escalates risks and controls in an interactive, proactive and dynamic manor. Workflow, alerts, messaging and roles and permission profiles route risk information to all relevant entities to ensure enterprise-wide visibility of, for example, a companies overall risk exposure.

Owner:PROVIDUS SOFTWARE SOLUTIONS

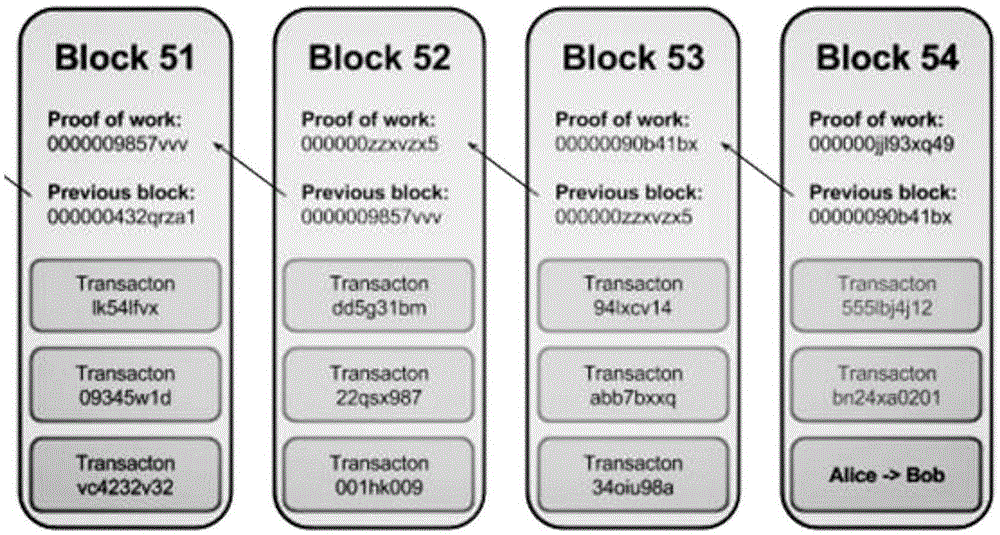

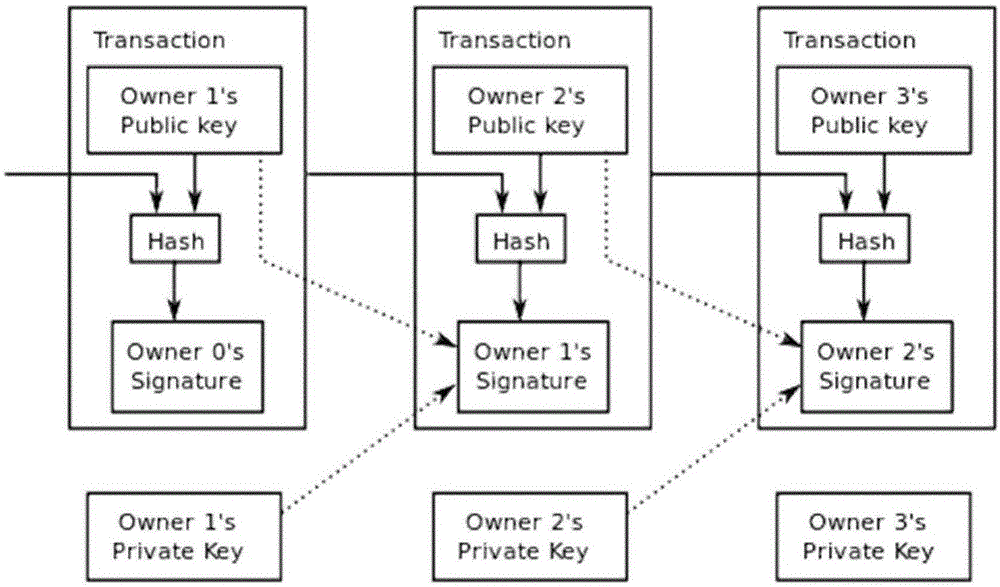

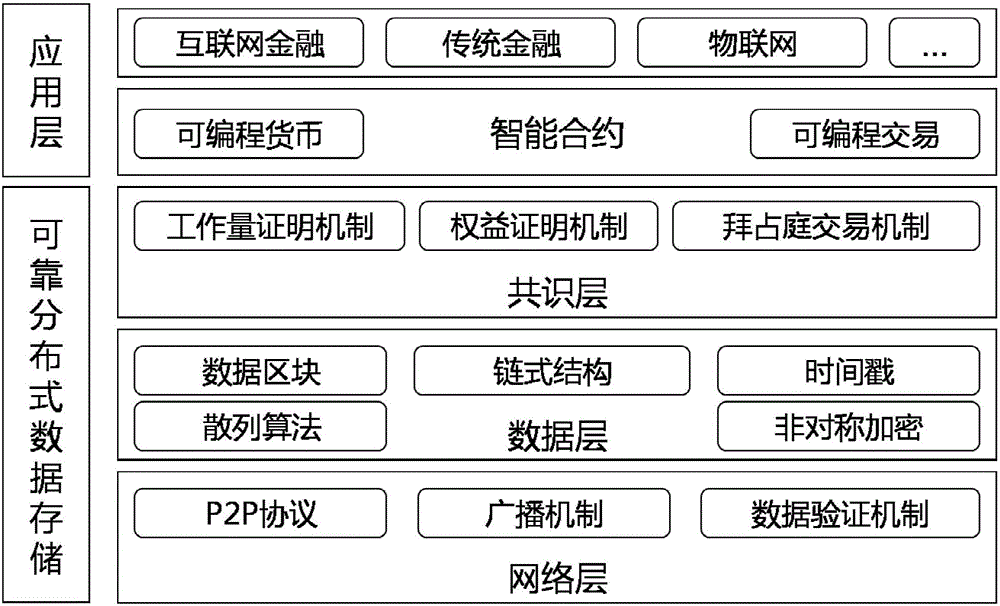

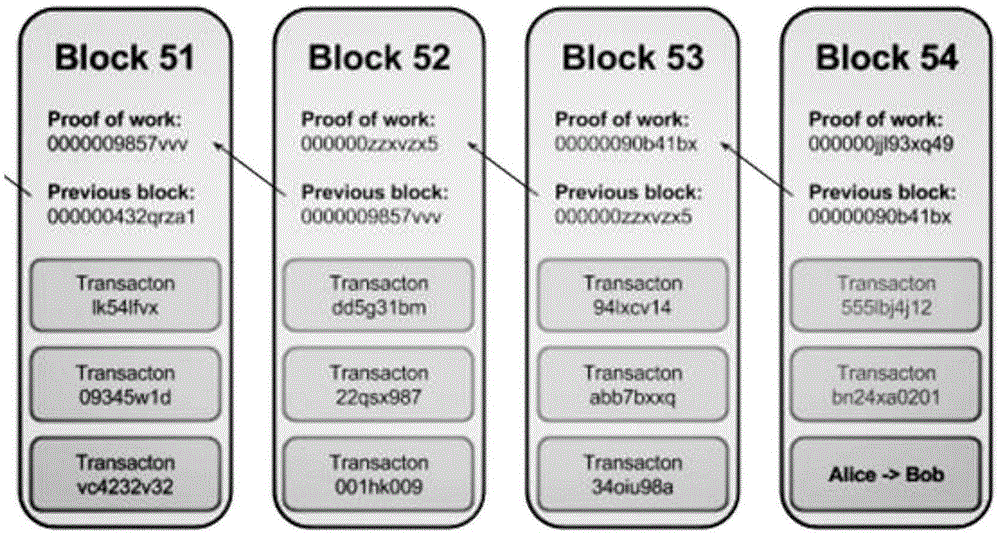

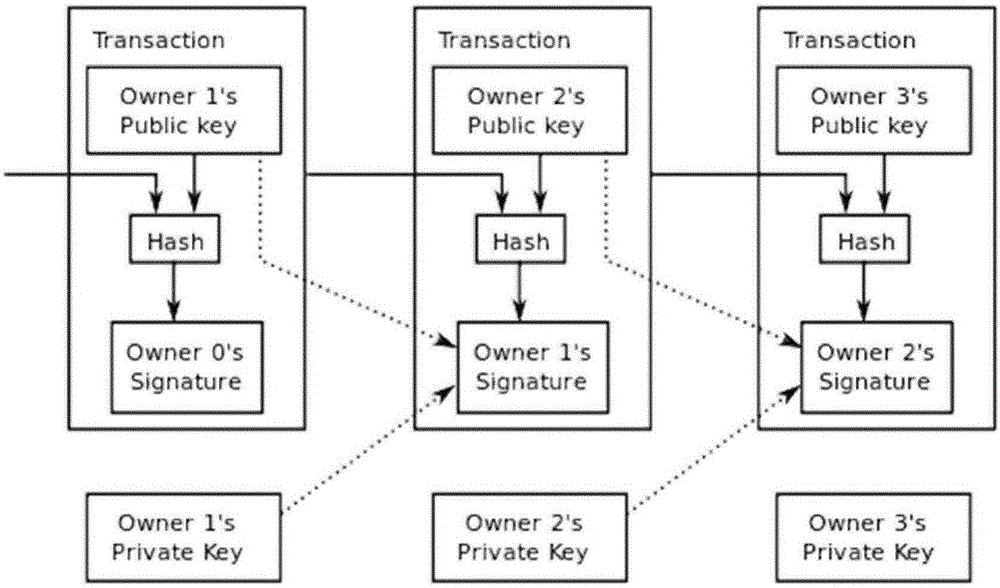

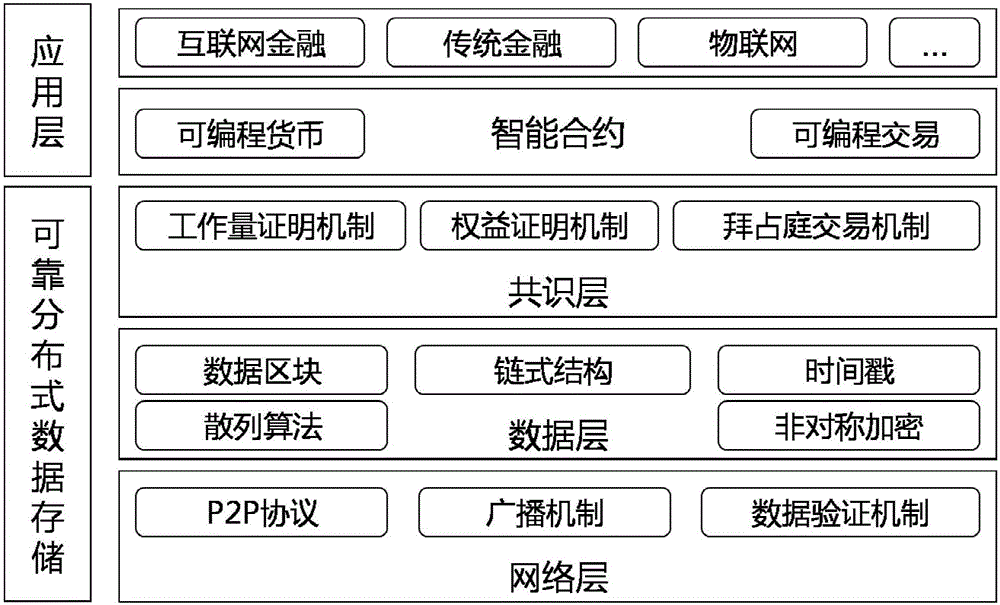

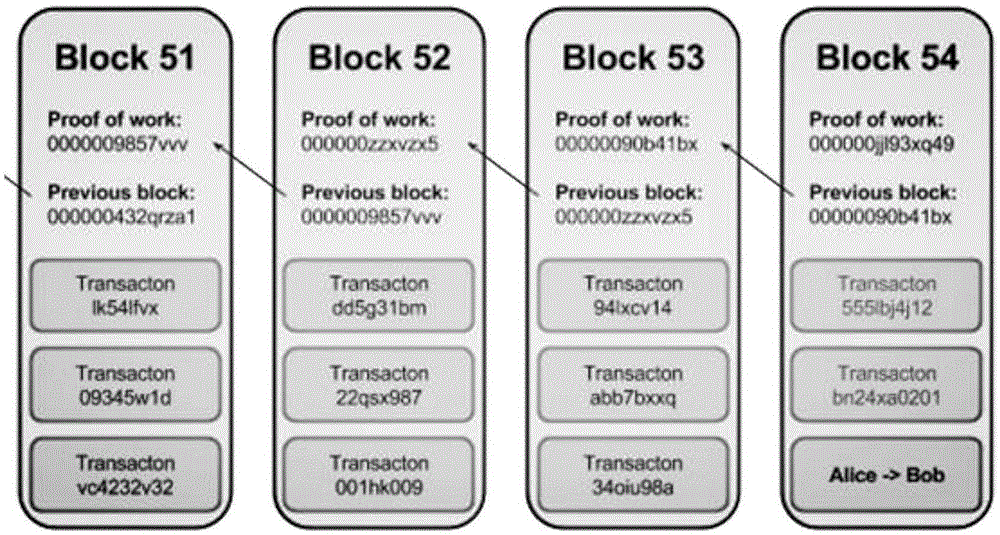

Block chain-based credit investigation data sharing and trading system

InactiveCN106651346APerfect risk control levelSolve imperfectionsPayment protocolsBuying/selling/leasing transactionsRisk ControlData provider

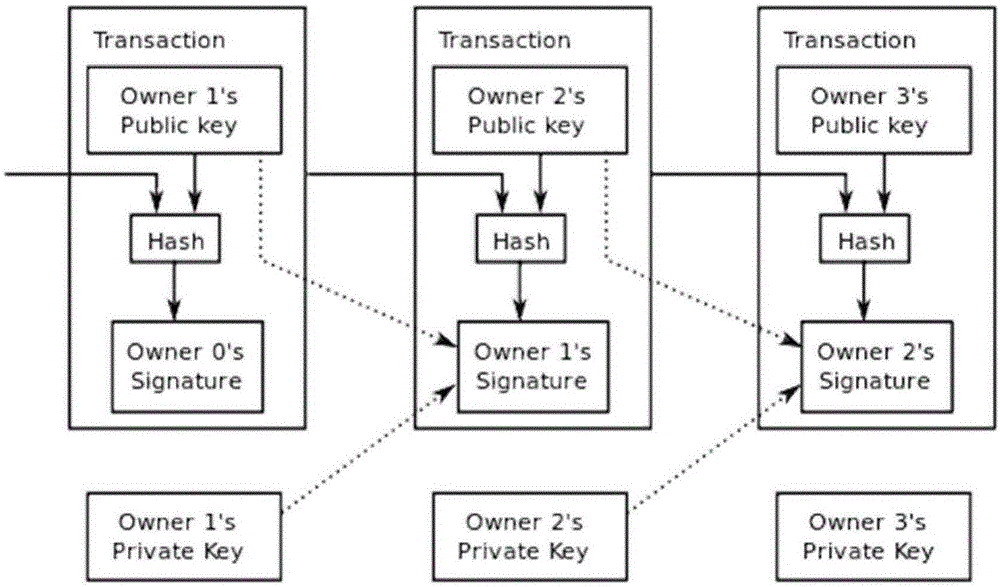

The invention relates to a block chain-based credit investigation data sharing and trading system. The credit investigation data sharing and trading system comprises at least two P2P network nodes; each network node comprises an underlying block chain system and a credit investigation data sharing platform running in the underlying block chain system; and the credit investigation data sharing platform comprises a data sharing module, a data query trading module, a member management module and a block chain adaption layer. According to the credit investigation data sharing and trading system, a trusted credit investigation data sharing and trading platform is established by using a block chain technology; and special data sharing mechanism, data query mechanism and data trading mechanism are used, so that credit investigation data owners and credit investigation data demanders can be attracted to perform use, credit investigation data providers can perform data trading under the condition that data is protected, and credit investigation data queriers can obtain the credit investigation data to improve risk control levels of themselves.

Owner:上海凯岸信息科技有限公司

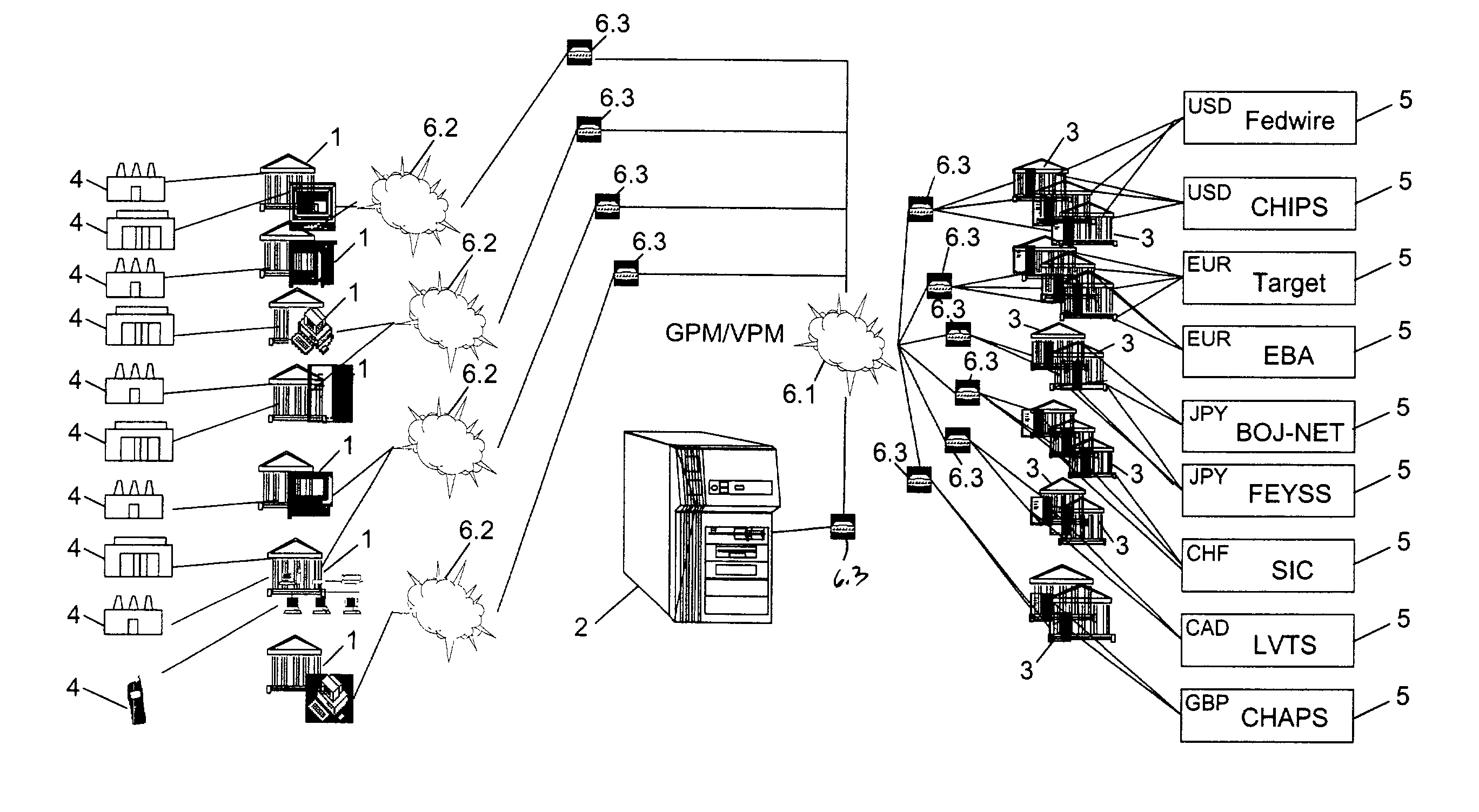

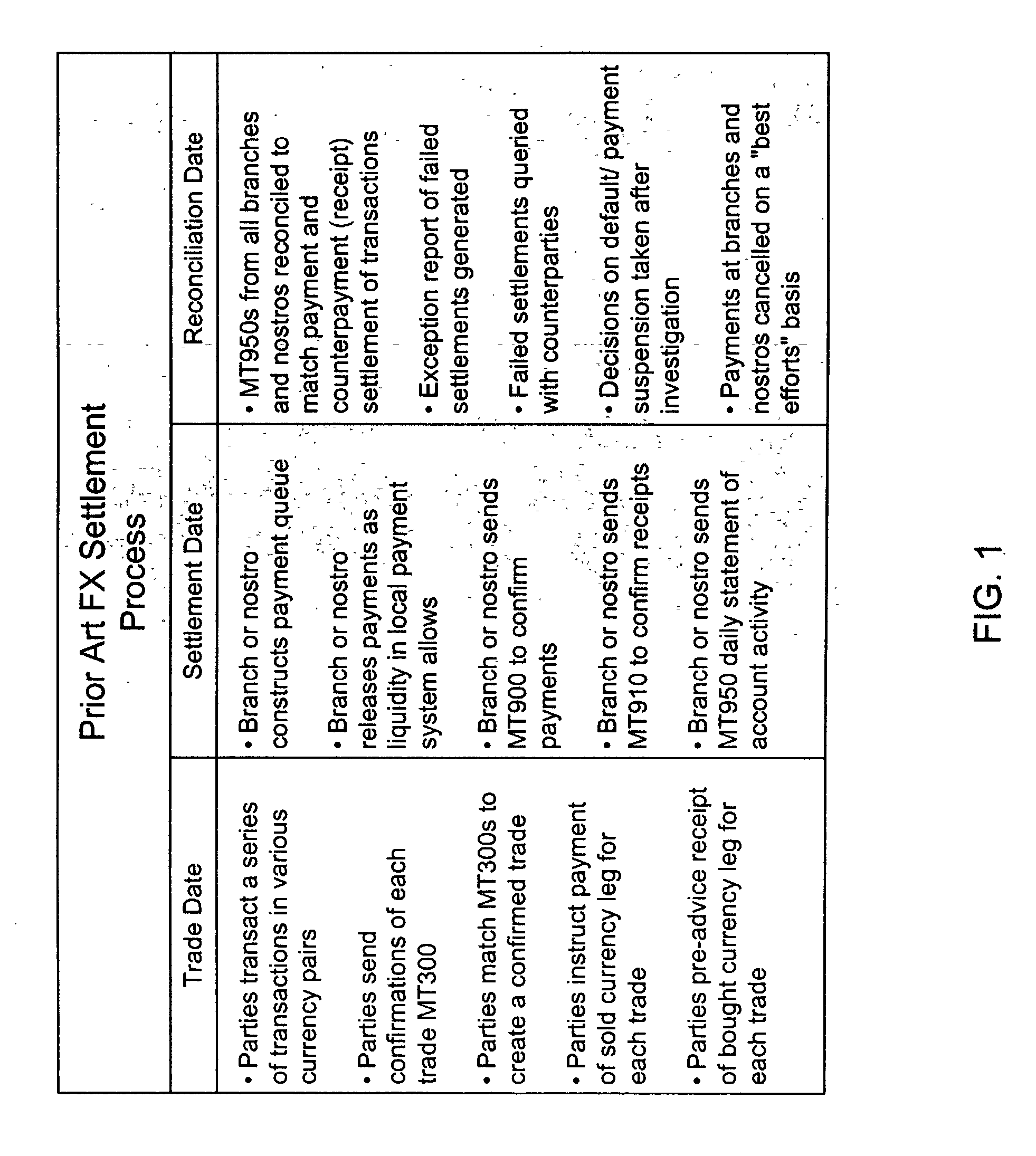

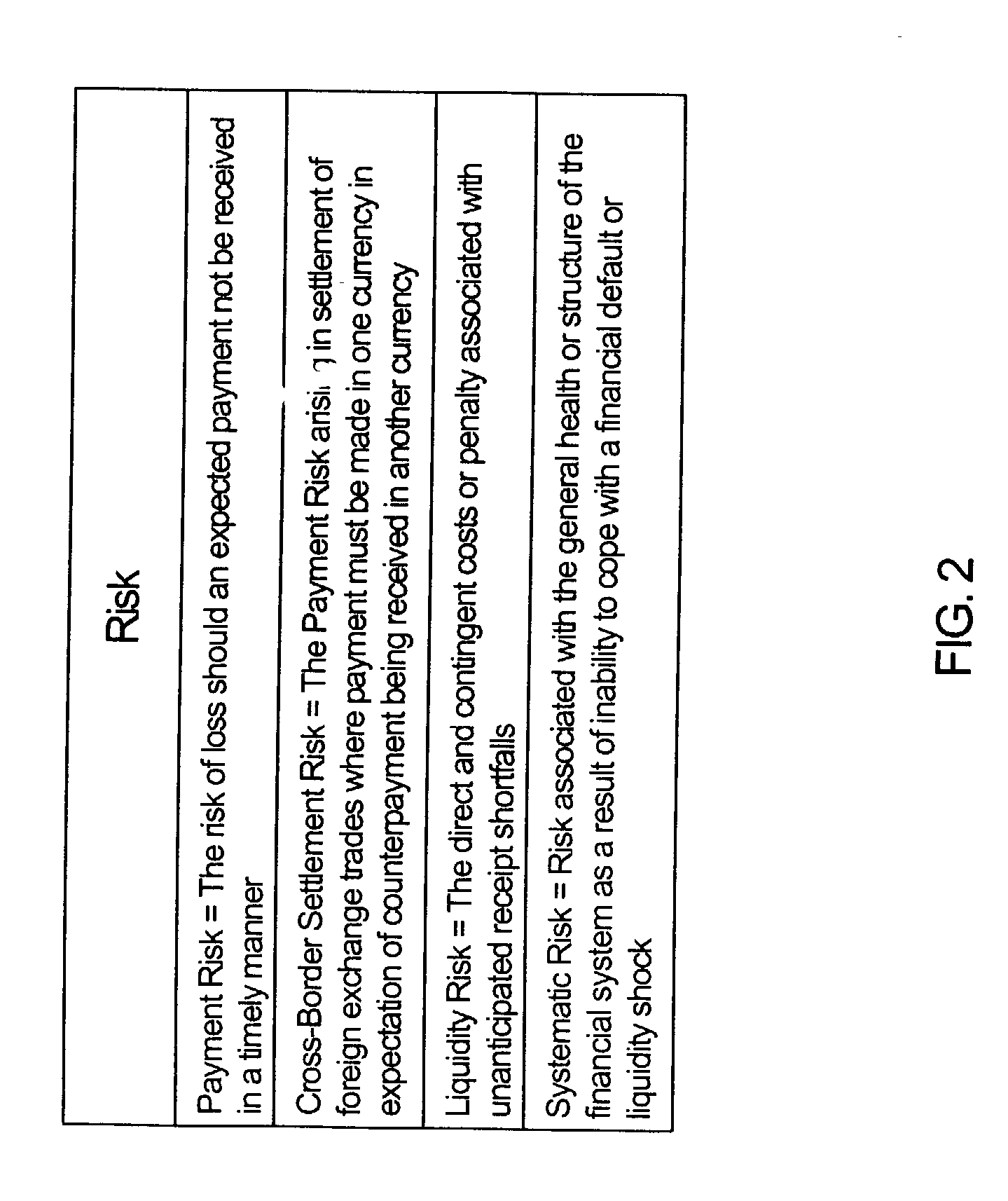

Method of and system for mitigating risk associated with settling of foreign exchange and other payments-based transactions

InactiveUS20020152156A1Improve liquidityFacilitates broad range of communicationFinanceBilling/invoicingPrivate communicationThird party

A real-time, global system and method for controlling payments risk, liquidity risk and systemic risk arising between financial counterparties active in payments-based transactions. The system comprises: a plurality of User Host Applications for use by plurality of Users; a plurality of Third Party Host Applications for use by plurality of Third Parties; and a plurality of Payment Bank Host Applications for use by a plurality of Payment Banks operating a plurality of domestic payment systems. All host applications communicate via cryptographically secure sessions via private communications networks and / or the Internet global computer network. User and Payment Bank access is secured by digital certification. Each Payment Bank Host Application has a mechanism for processing payment messages, including payments instructions to be carried out in its domestic payments system on behalf of a plurality of account holders (including bank correspondents). In addition, each Payment Bank Host Application includes a filter process module for processing payments instructions, prior to being carried out by the domestic payment system. In the event of a counterparty payment failure or insolvency, the Filter Process Module enables instantaneous, automated suspension of all further payments to the counterparty in a multiplicity of chosen currencies on instruction from a Third Party, User or Payment Bank. The filter process module can also be instructed to override risk control parameters to enable payments to proceed regardless for identified transactions, counterparties or intermediaries. All applications improve the availability and timeliness of payments information. The reduction in payments risk and liquidity risk to predetermined tolerances reduces the likelihood of contingent defaults in the event of payment failure due to bank insolvency or other unforeseen event, and thereby reduces systemic risk to the global financial system.

Owner:MIND FUSION LLC

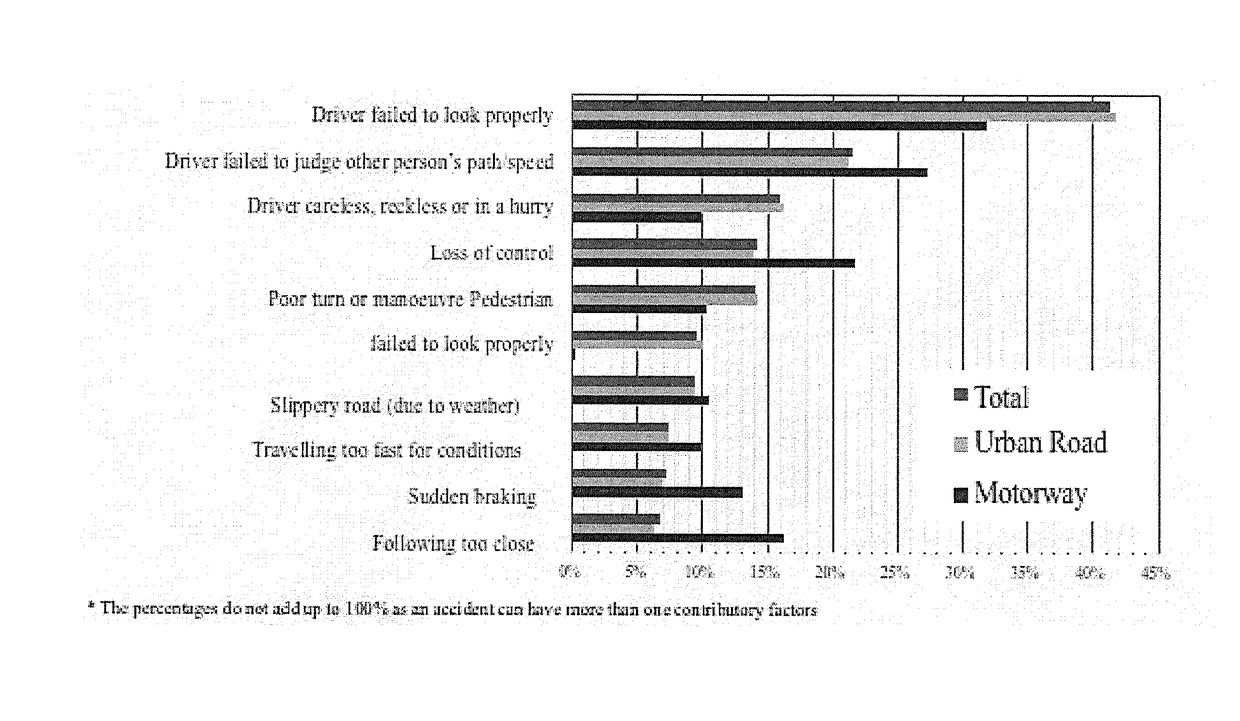

Autonomous or partially autonomous motor vehicles with automated risk-controlled systems and corresponding method thereof

ActiveUS20170372431A1Improve system stabilityImprove stabilityFinanceRegistering/indicating working of vehiclesPaymentRisk exposure

Aspects of the disclosure include a first risk-transfer system, a second risk-transfer system, and an expert-system based circuit. The first risk-transfer system is configured to provide a first risk-transfer based on first risk-transfer parameters from a plurality of motor vehicles to the first risk-transfer system, and receive and store first payment parameters associated with risk exposures of the plurality of motor vehicles. The second risk-transfer system is configured to provide a second risk-transfer based on second risk-transfer parameters from the first risk-transfer system to the second risk-transfer system, and receive and store second payment parameters associated with risk exposures transferred to the first risk-transfer systems. The expert-system based circuit is configured to receive environmental parameters and operating parameters from the plurality of motor vehicles, adjust the first risk transfer parameters and correlated first payment transfer parameters, and adjust the second risk transfer parameters and correlated second payment transfer parameters.

Owner:SWISS REINSURANCE CO LTD

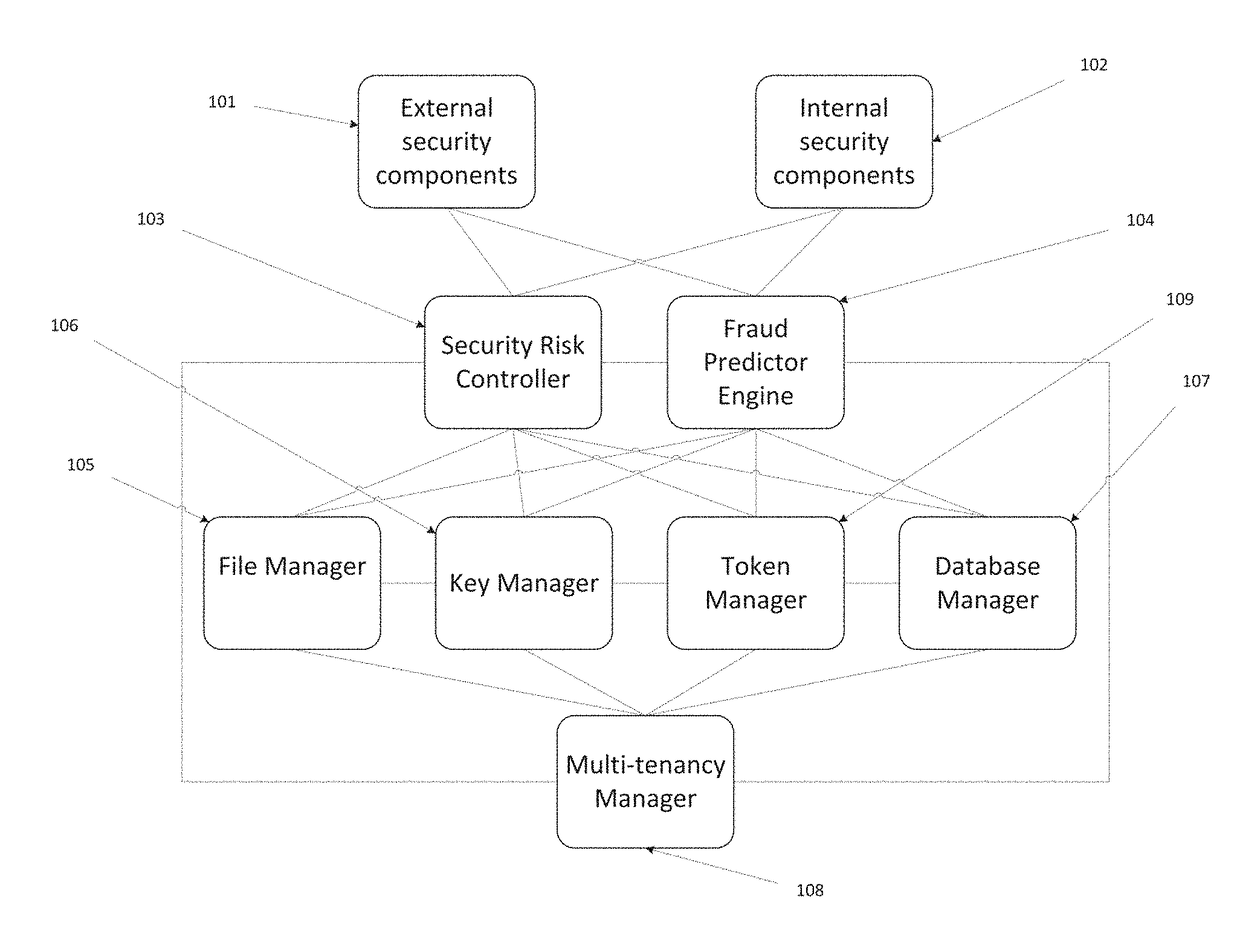

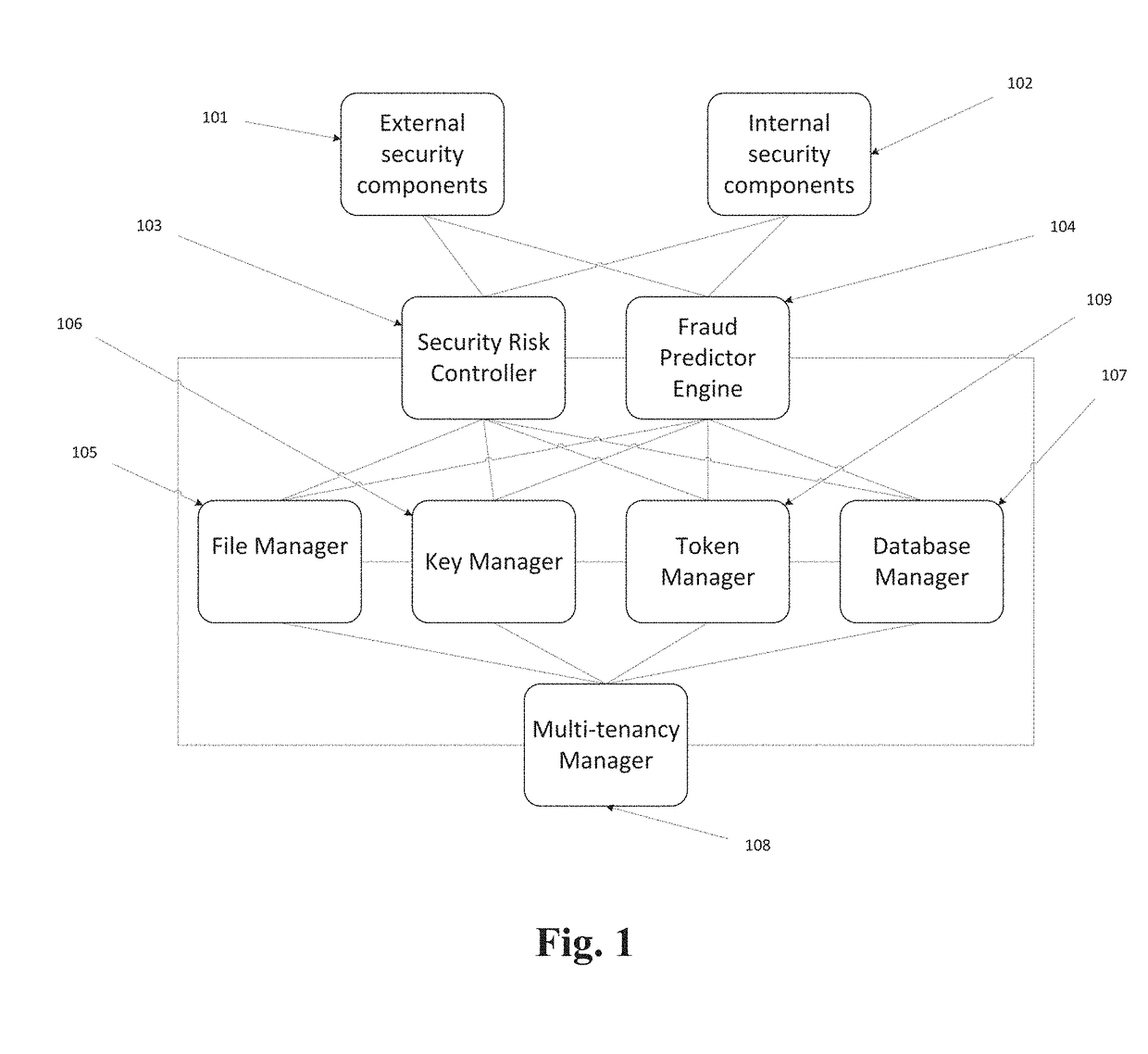

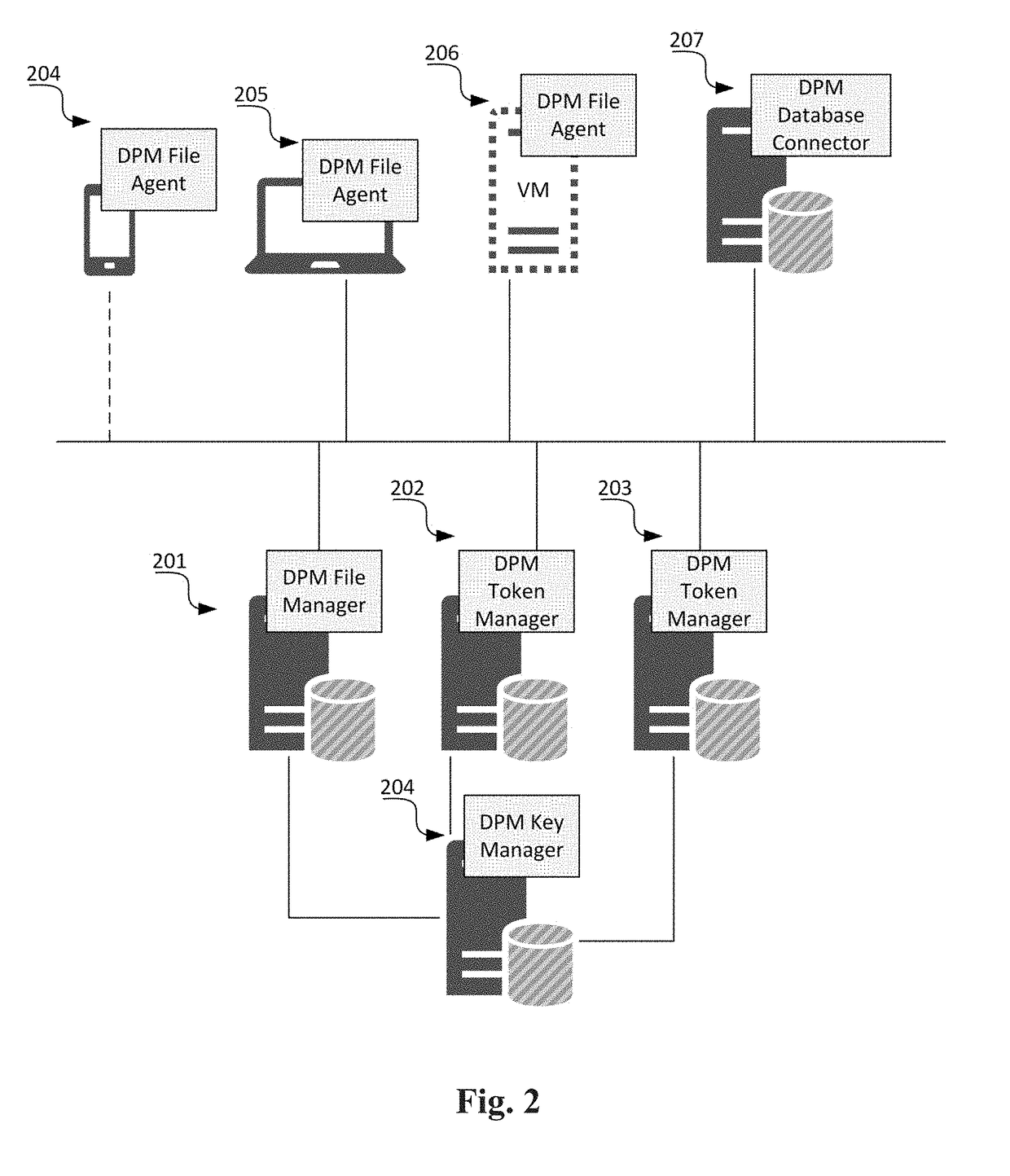

Method and system for digital privacy management

Data Privacy Manager (DPM) solution includes a number of different components performing data security procedures (encryption, masking, tokenization, Anonymization, etc.) at the folder, file, email, application, database and column levels. These include components such as Key Manager, File Manager, File Agent, Email Agent, Database Manager, Database Connector, the Token Manager, Security Risk Controller and Fraud Predictor. All these components can be managed through a management console.

Owner:ADHAR VIRESHWAR K

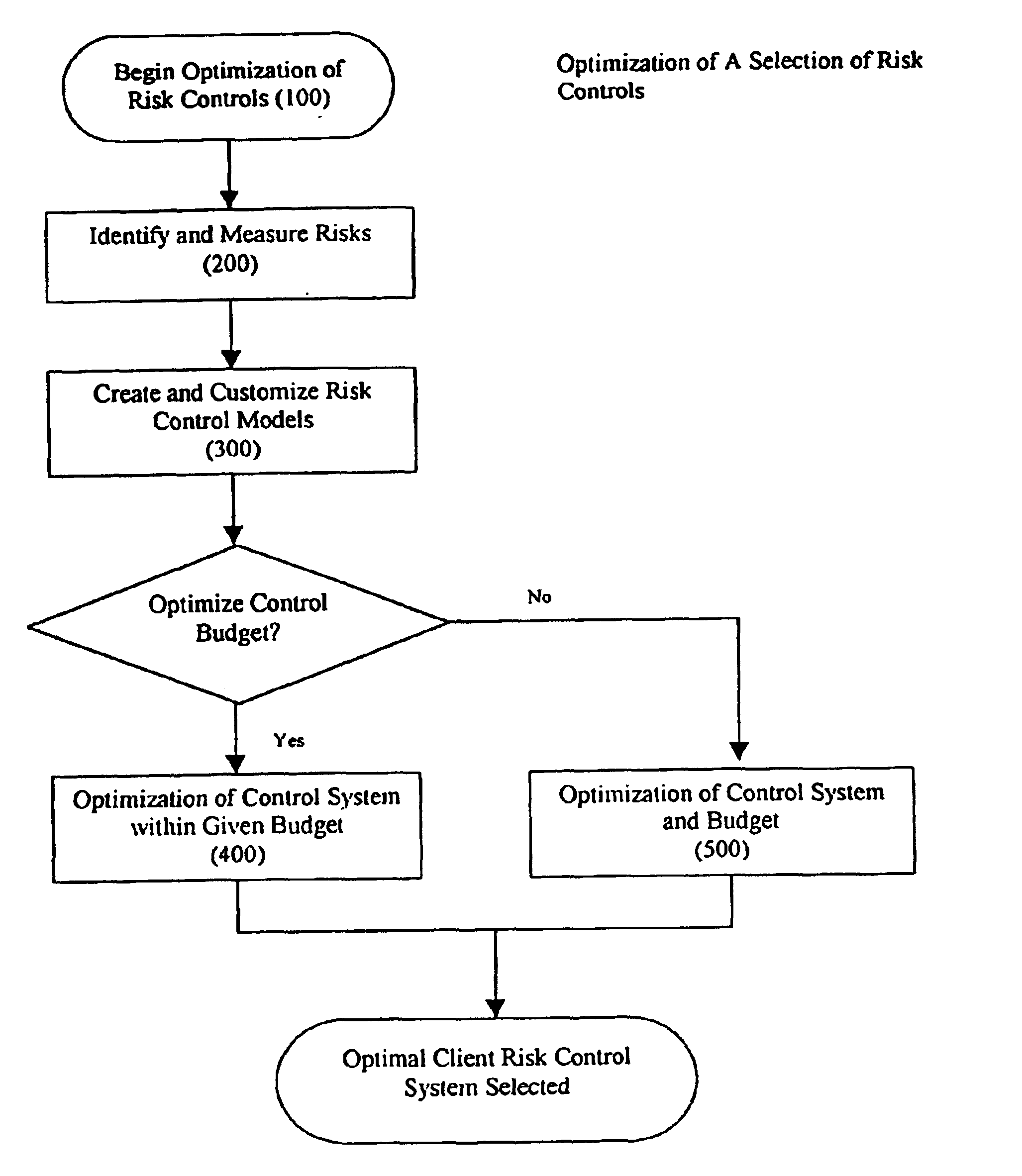

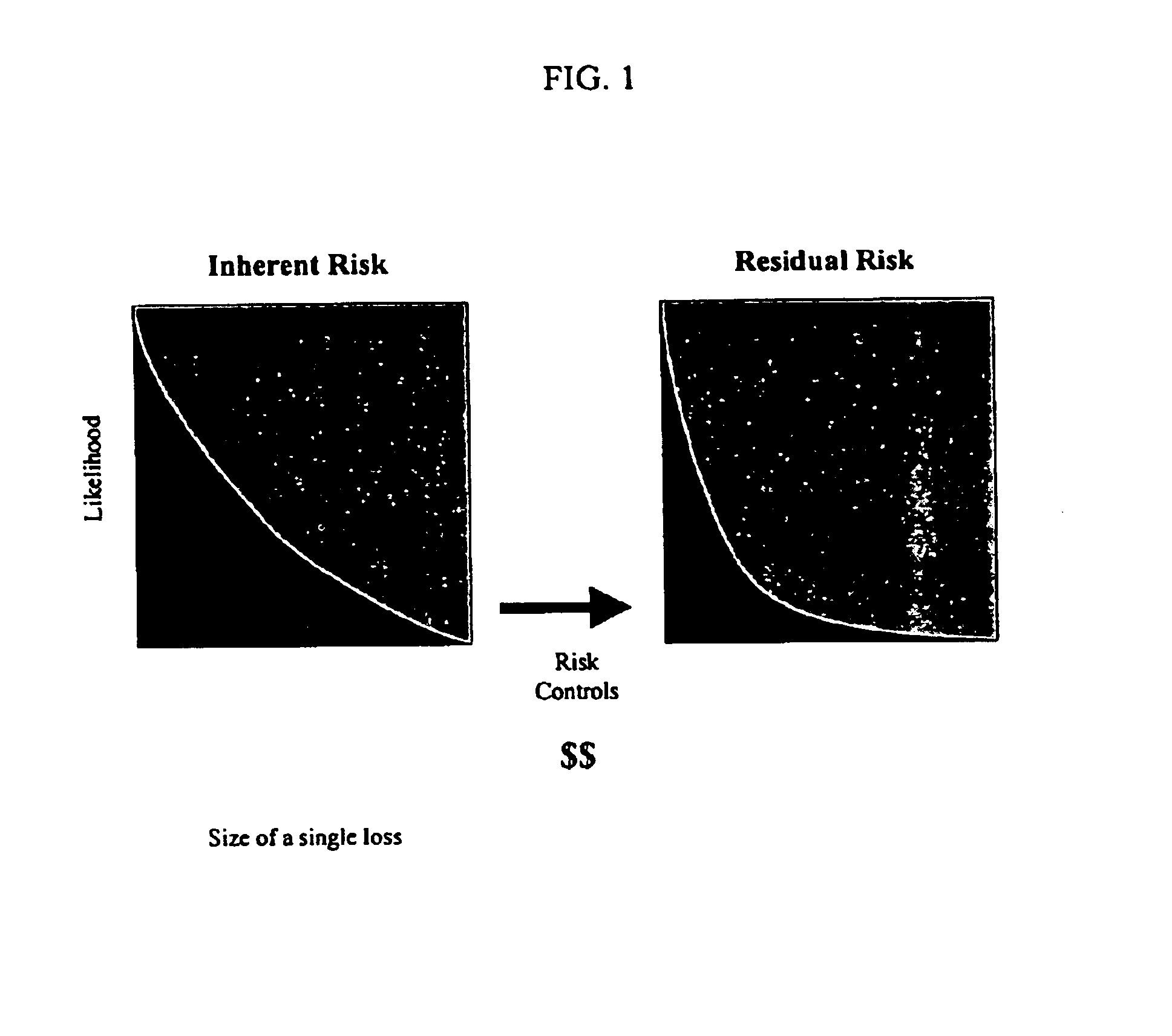

Method and system for risk control optimization

InactiveUS6876992B1Economic value maximizationHigh economic valueFinanceComputation using non-denominational number representationRisk exposureRisk Control

A method and system for selecting an optimal set of management and risk controls for a given set of risks within a variable control budget. Specifically, optimization according to the present invention is defined using a method and system to calculate the greatest reduction in an organization's risk exposure with the minimum investment in cost and time as measured by the economic value added of the risk system change. Risk control models and management risk control models are client customized into a risk control system specifically addressing a clients applicable risks and their associated exposures. An operator is able to determine which risk control system maximizes available resources while also reducing an organization's total risk exposure.

Owner:WILLIS NORTH AMERICA

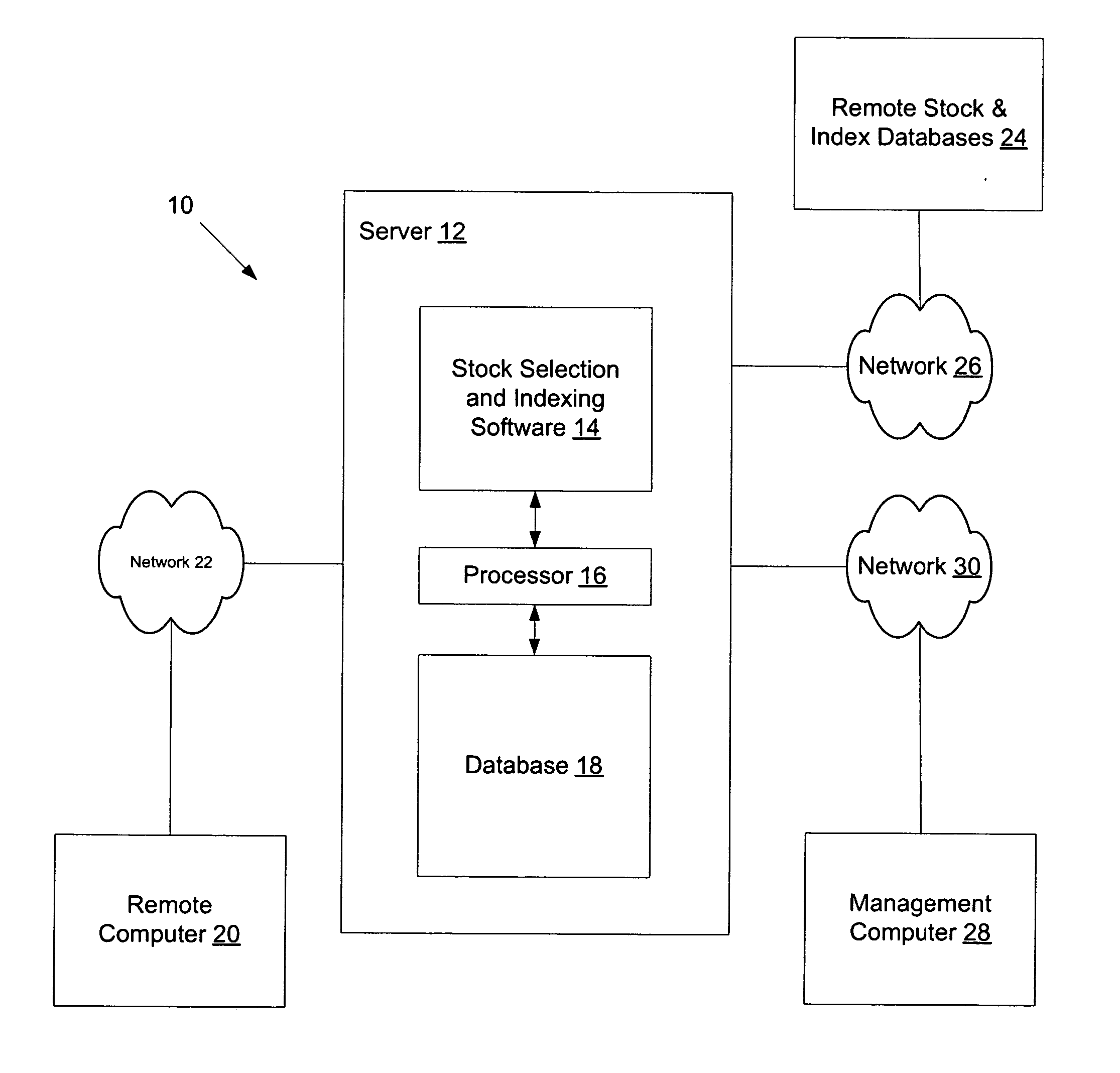

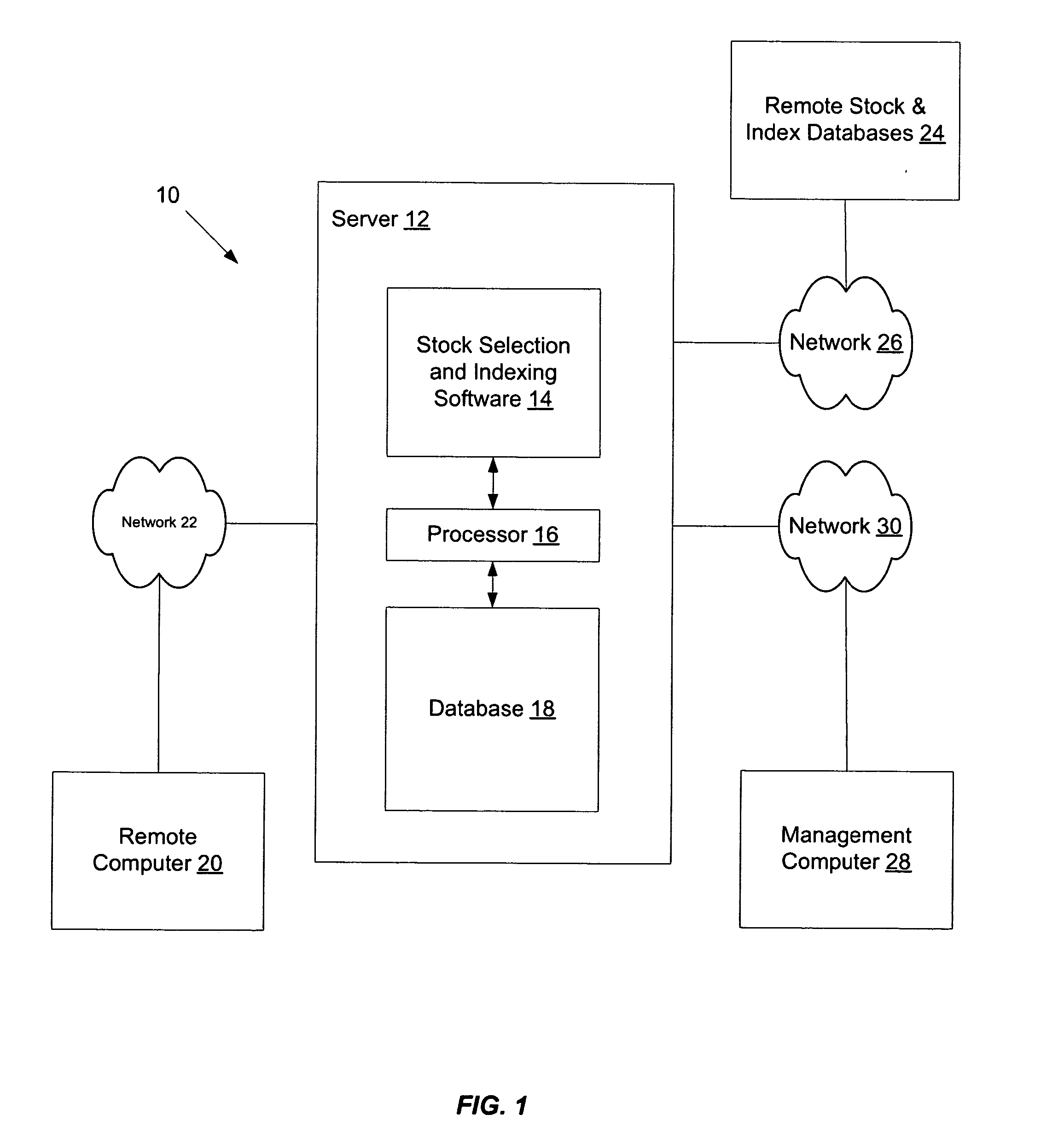

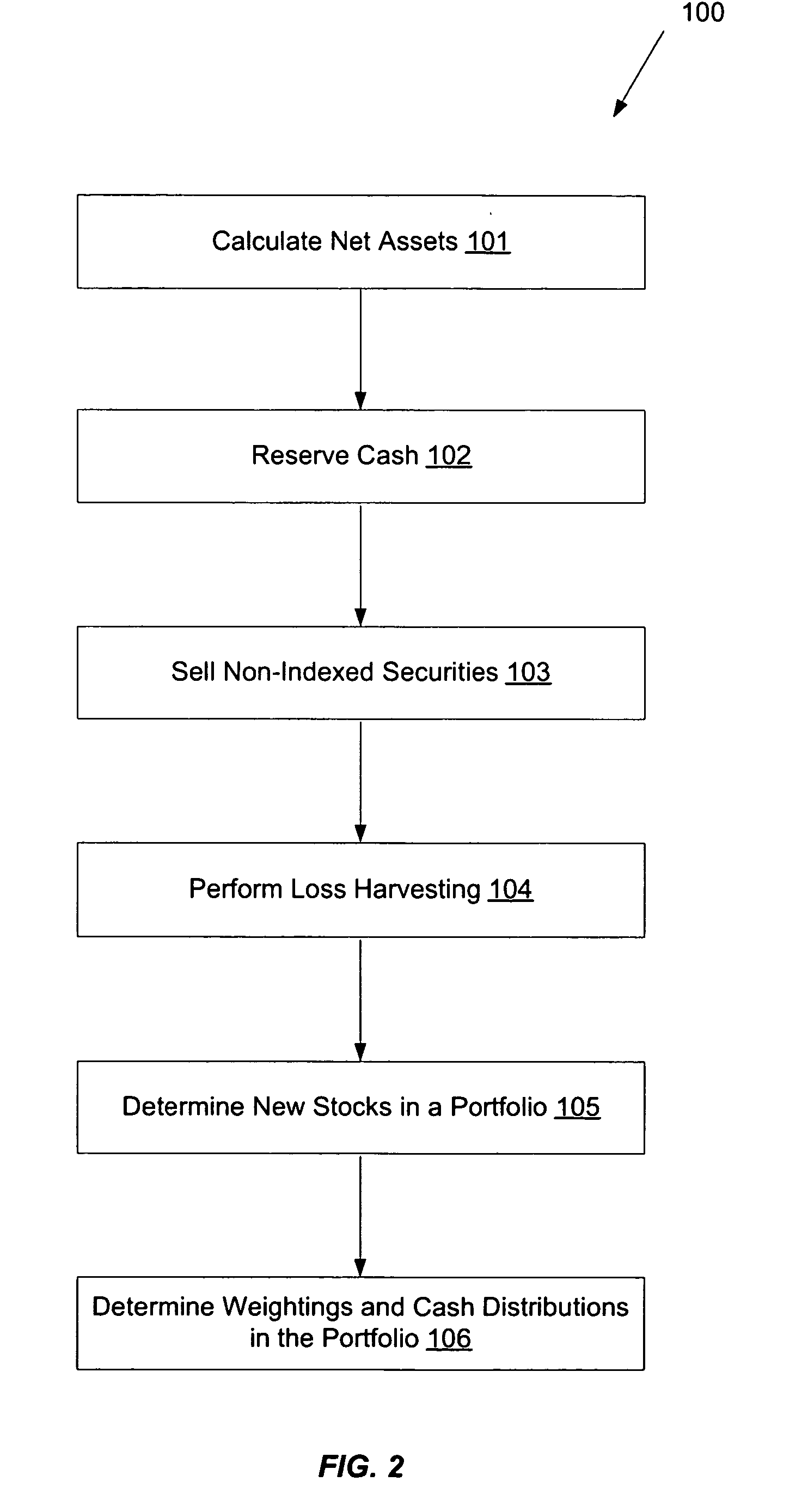

Stock selection & indexing systems and methods

InactiveUS20050049952A1Low costControlling the riskFinanceSpecial data processing applicationsRisk ControlEngineering

A system, method and software product describe a customizable, index-based stock management methodology. This methodology provides for diversification and risk control of indexing combined with individual customization and active tax management. The system employing the methodology permits individual investors to invoke investment processes that track indexes to gain specified market exposure, control risk, and minimize costs while invoking individual preferences, current holdings, or social concerns

Owner:ACTIVE INDEX ADVISORS

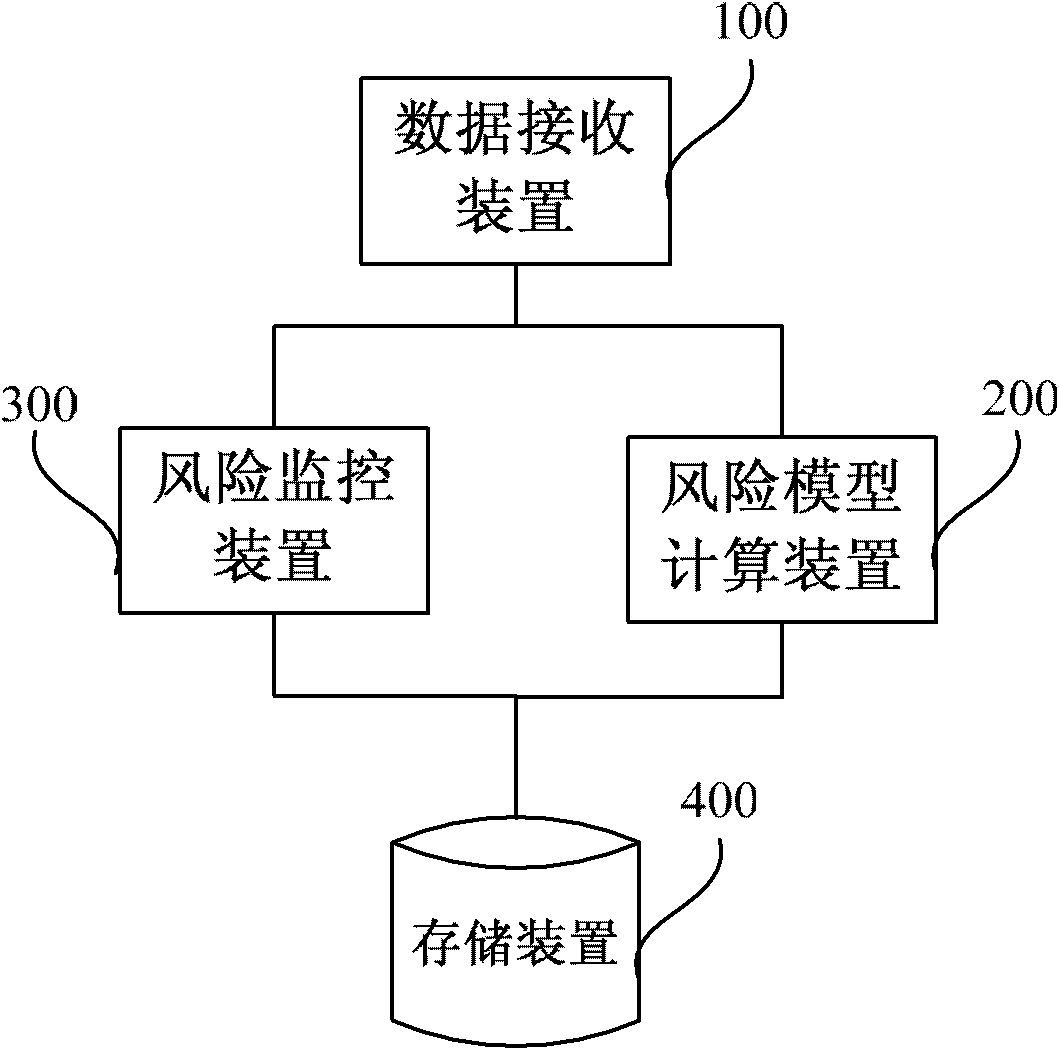

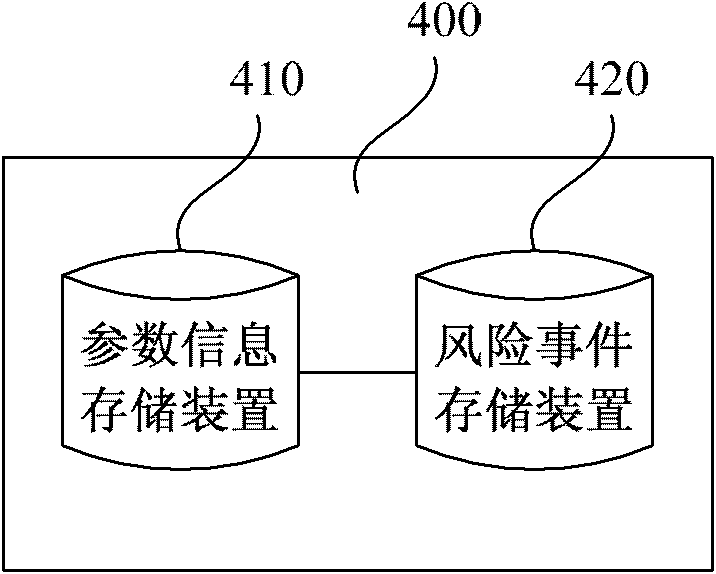

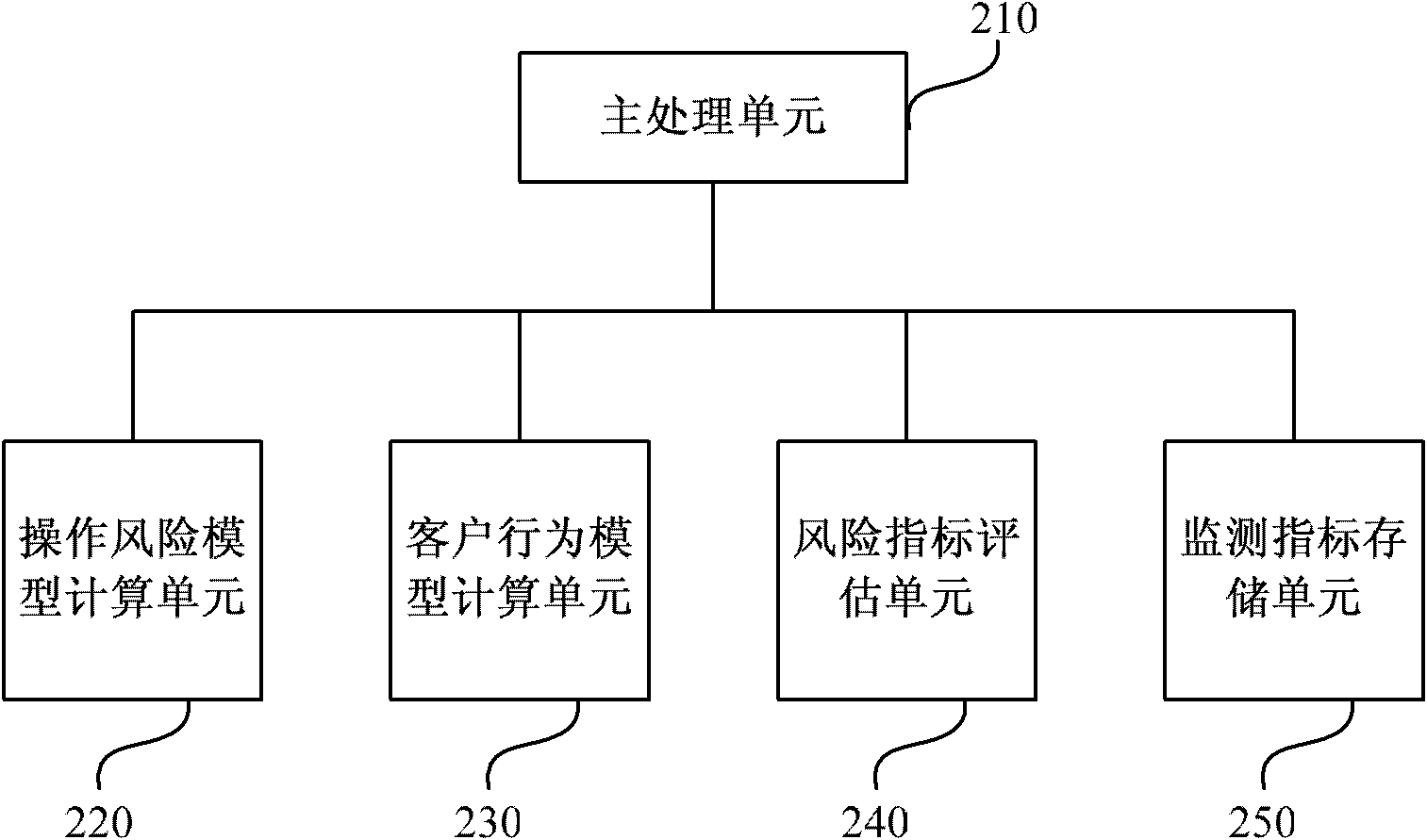

Processing method and system for risk monitoring and controlling of transaction data

The embodiment of the invention discloses a processing method and a system for risk monitoring and controlling of the transaction data. The method comprises the following steps: receiving the transaction data generated in the business processing information; calling the related transaction data of the transaction data according to the transaction data; calculating the risk monitoring index data threshold value according to the transaction data and the related transaction data; judging that the business processing information generating the transaction data is quasi-risk business processing information when the transaction data is more than the risk monitoring index data threshold value; and setting the quasi-risk business processing information into the risk business processing information. The method and the system of the invention can automatically generate a risk control threshold value, identifies and controls the risk according to the different conditions, can provide a risk monitoring process flow and a rule improvement mechanism, thus saving the economic cost, improving the accuracy and the efficiency of the risk event checking, and greatly improving the monitoring efficiency and effect of the banking business risks.

Owner:INDUSTRIAL AND COMMERCIAL BANK OF CHINA

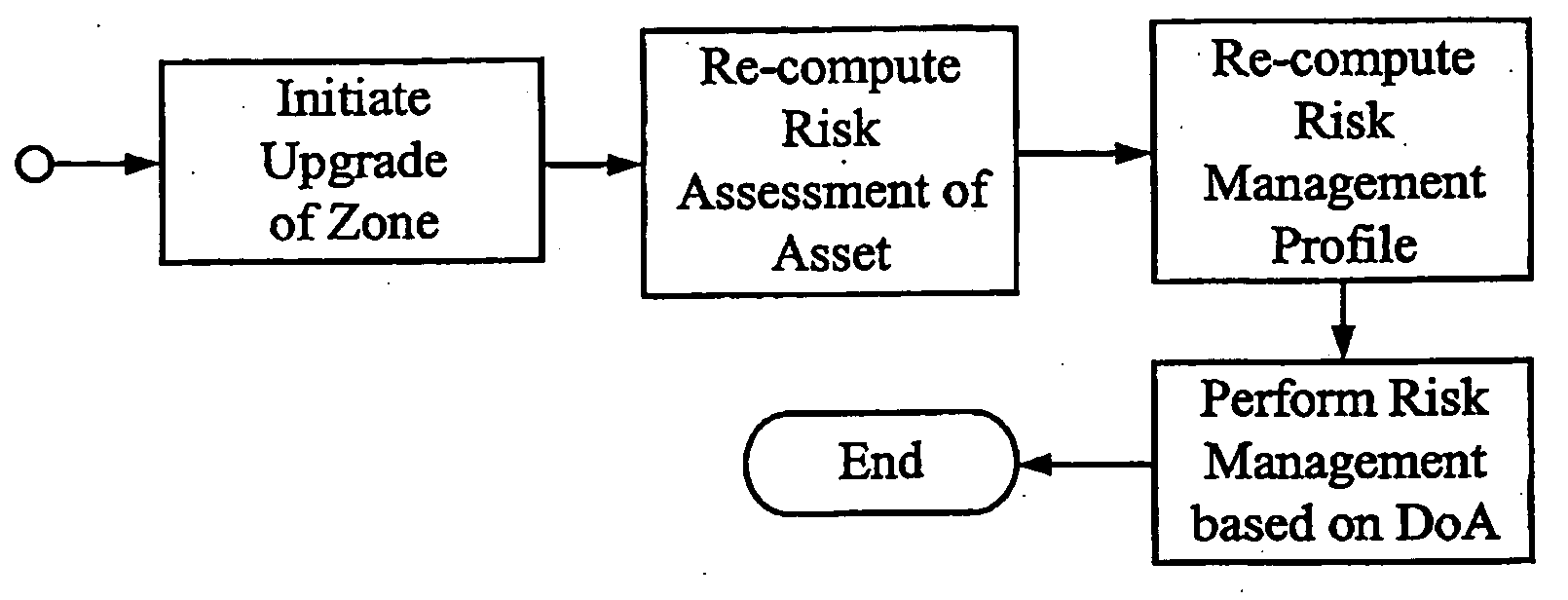

Risk control system

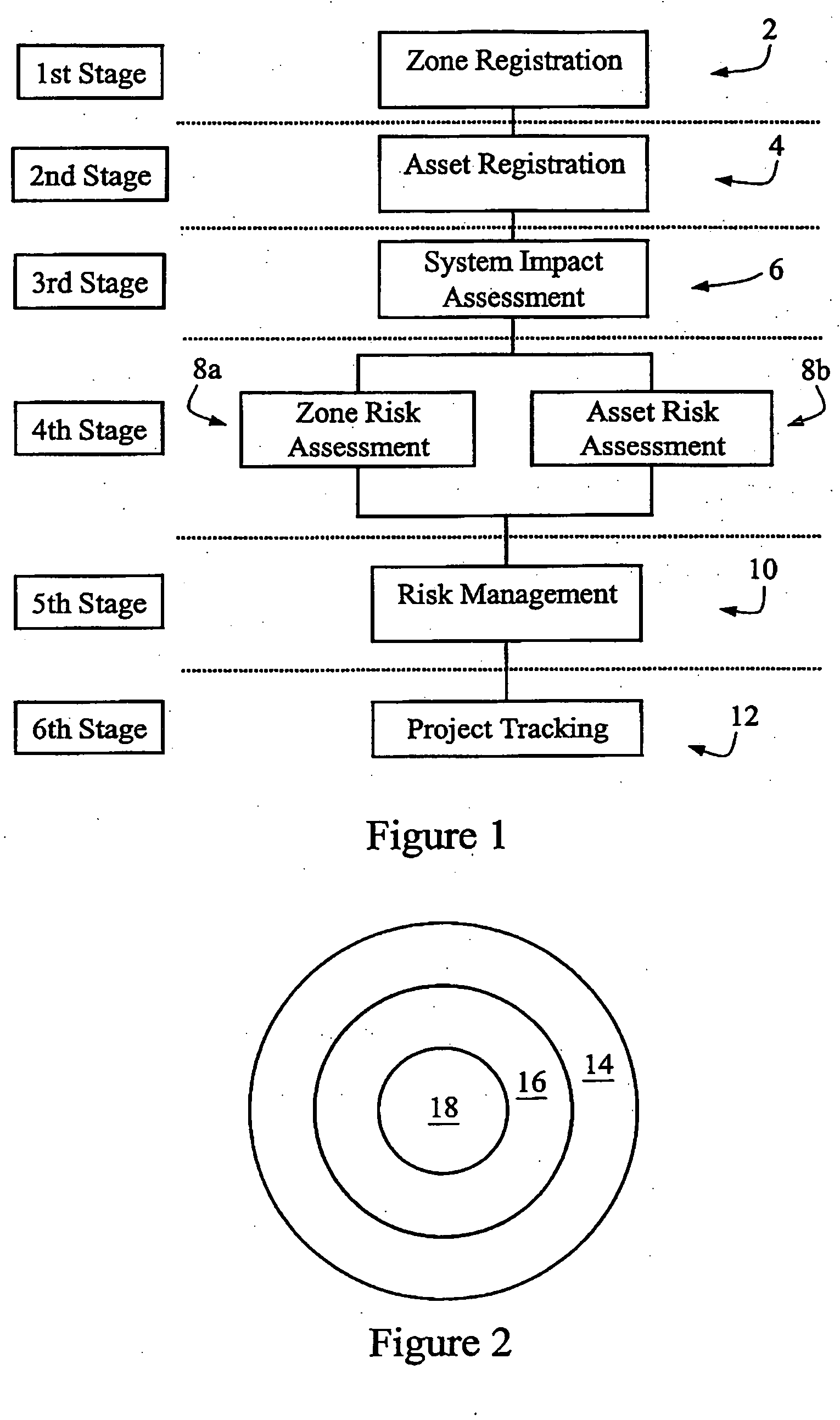

The invention provides a method for assessing risk within an organization, comprising: defining one or more zones (2), each of the one or more zones comprising an environment; identifying one or more assets (4) of the organization, each of the assets being located in a respective one of the zones; conducting a respective impact assessment (6) for each of the assets, each assessment comprising assessing the impact of the loss of the respective asset; conducting for each of the zones a respective zone risk assessment (8a), comprising assessing the risk level associated with placing a respective asset within the respective corresponding zone; and conducting for each asset a respective asset risk assessment (8b), comprising assessing the risk level associated with the respective asset independent of the respective zone of the respective asset; and assessing risk on the basis of at least the impact assessment, the zone risk assessments and the asset risk assessments. The invention also provides a risk management method, comprising assessing risk according to the method described above and managing said risk.

Owner:YOU CHENG HWEE

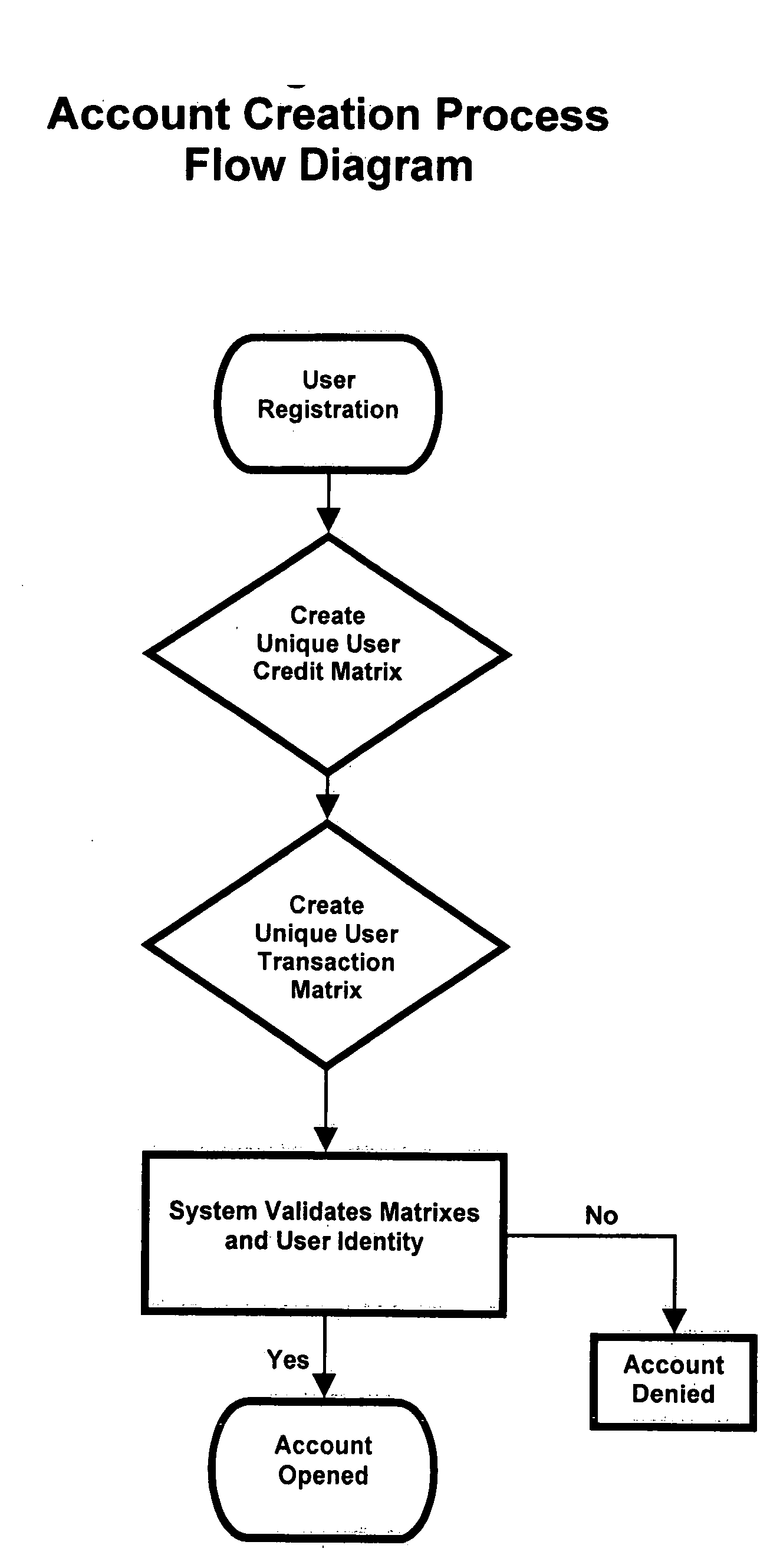

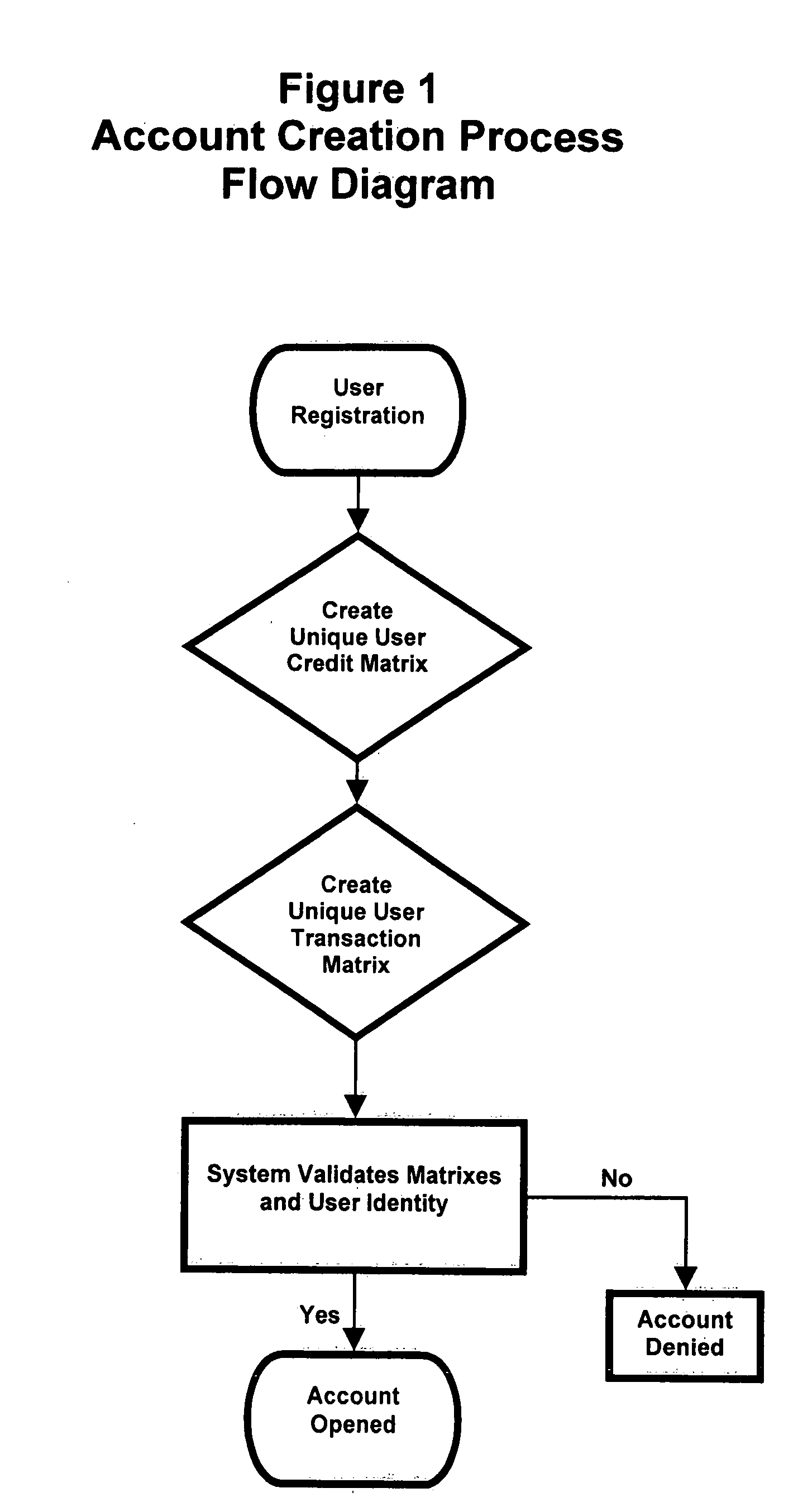

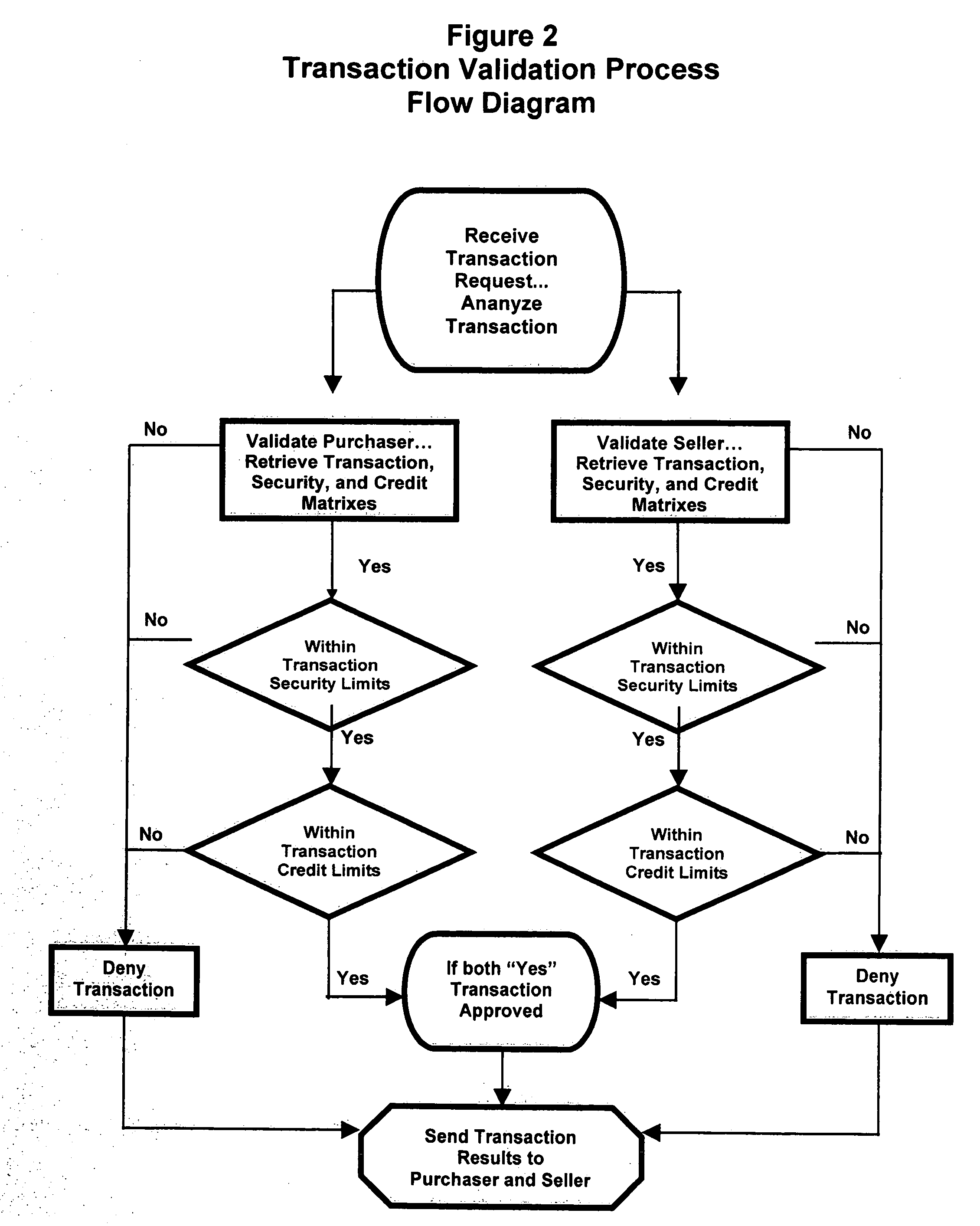

Mobile payment and accounting system with integrated user defined credit and security matrixes

InactiveUS20080255993A1Improve securityFinanceProtocol authorisationThe InternetFinancial transaction

A platform that accommodates financial transactions and is accessible via mobile phone networks, Internet and traditional methods is linked to user defined credit and security matrixes. Credit risk tolerance factors consider the qualifications, characteristics, and profile of counterparties. Security risk tolerance factors consider the user's willingness to use a particular financial platform in an environment where abuse, fraud, theft, and other security factors are of concern. In both cases the user creates matrixes that describe risk tolerance and financial transactions must successfully pass through the filters designed by the user. The system can be used alone or linked to bank accounts, credit and debit accounts, etc. This provides a higher level of security and risk control in a mobile or Web-based environment. By giving customers way to control risk, use of new electronic methods of payment and other financial transactions can be accommodated in a more comfortable, secure, and efficient manner.

Owner:BLINBAUM JACQUES

Credit-investigation data sharing and trading system based on block chain

InactiveCN106788987APerfect risk control levelSolve imperfectionsKey distribution for secure communicationFinanceRisk ControlData provider

The invention relates to a credit-investigation data sharing and trading system based on a block chain. The credit-investigation data sharing and trading system comprises at least two P2P network nodes; the network nodes include a bottom block chain system and a credit-investigation data sharing platform operating on the bottom block chain system; and the credit-investigation data sharing platform comprises a data sharing module, a data evaluating module, a data inquiring and trading module and a block chain adaptation layer. According to the credit-investigation data sharing and trading system disclosed by the invention, a credible credit-investigation data sharing and trading platform is constructed by using a block chain technology; a specific data sharing mechanism, data inquiring mechanism, data trading mechanism and data evaluating mechanism are used; therefore, a credit-investigation data owner and a credit-investigation data demander can be attracted to use; therefore, a credit-investigation data provider can realize data transaction in a condition that data is protected; a credit-investigation data inquirer can obtain credit-investigation data; and thus, the risk control level can be completed.

Owner:树读(上海)信息科技有限公司

Internal audit operations for sarbanes oxley compliance

A system provides audit opinions on an enterprise's organizations, processes, risks, and risk controls. The system first evaluates the enterprise's set of risk controls. The audit opinions of the set of risk controls are used to evaluate the set of risks associated with the set of risk controls. The audit opinions of the set of risks and of the set of risk controls are in turn used to evaluate the set of processes associated with the set of risks. Finally, all of these audit opinions are used to evaluate the set of organizations associated with the set of processes. The system streamlines the evaluation of risk by determining suggested audit opinions. Suggested audit opinions for a given item can be determined from audit opinions previously determined and associated with the given item. Rules can be defined for a given item to specify how to determine the suggested audit result.

Owner:ORACLE INT CORP

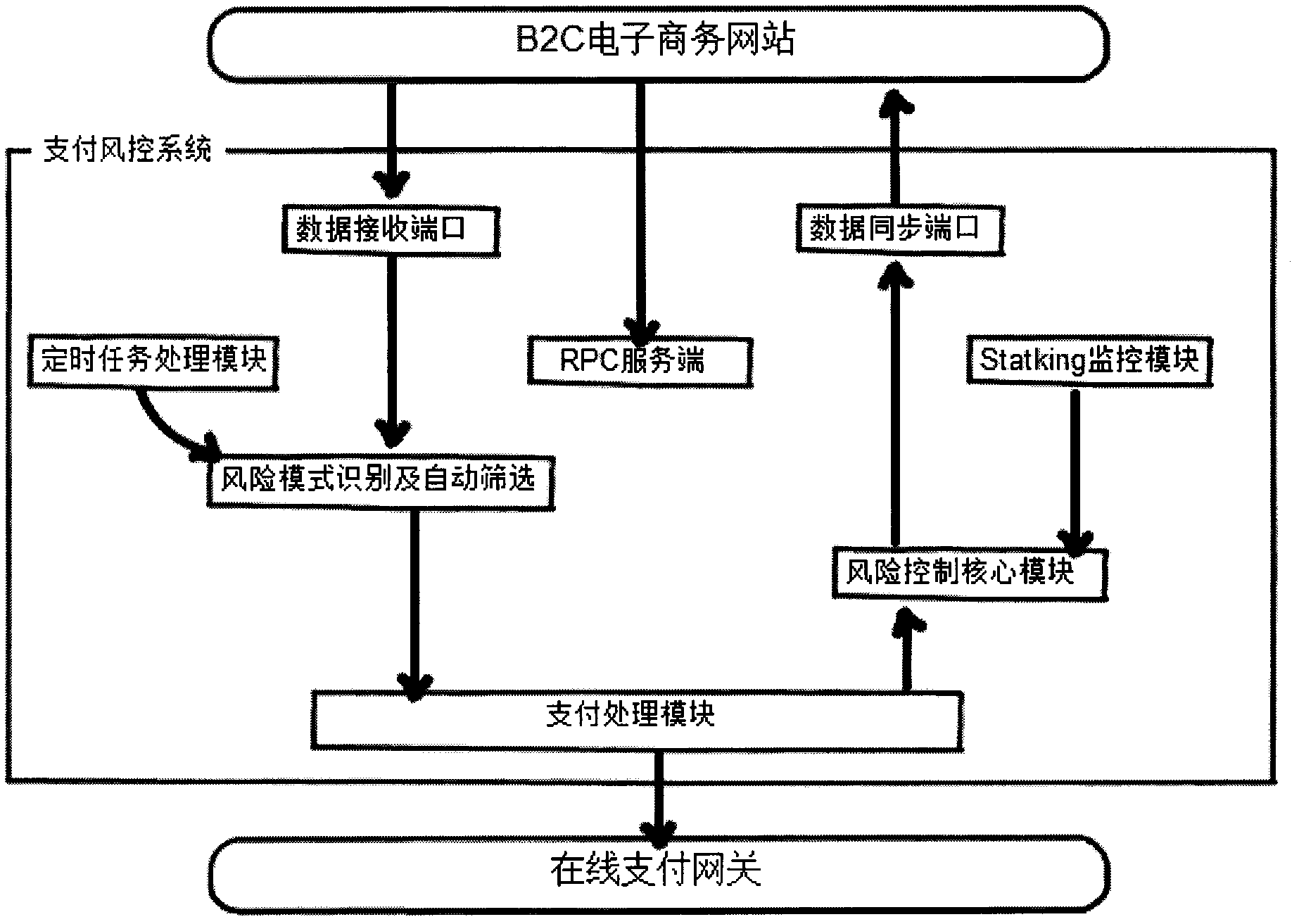

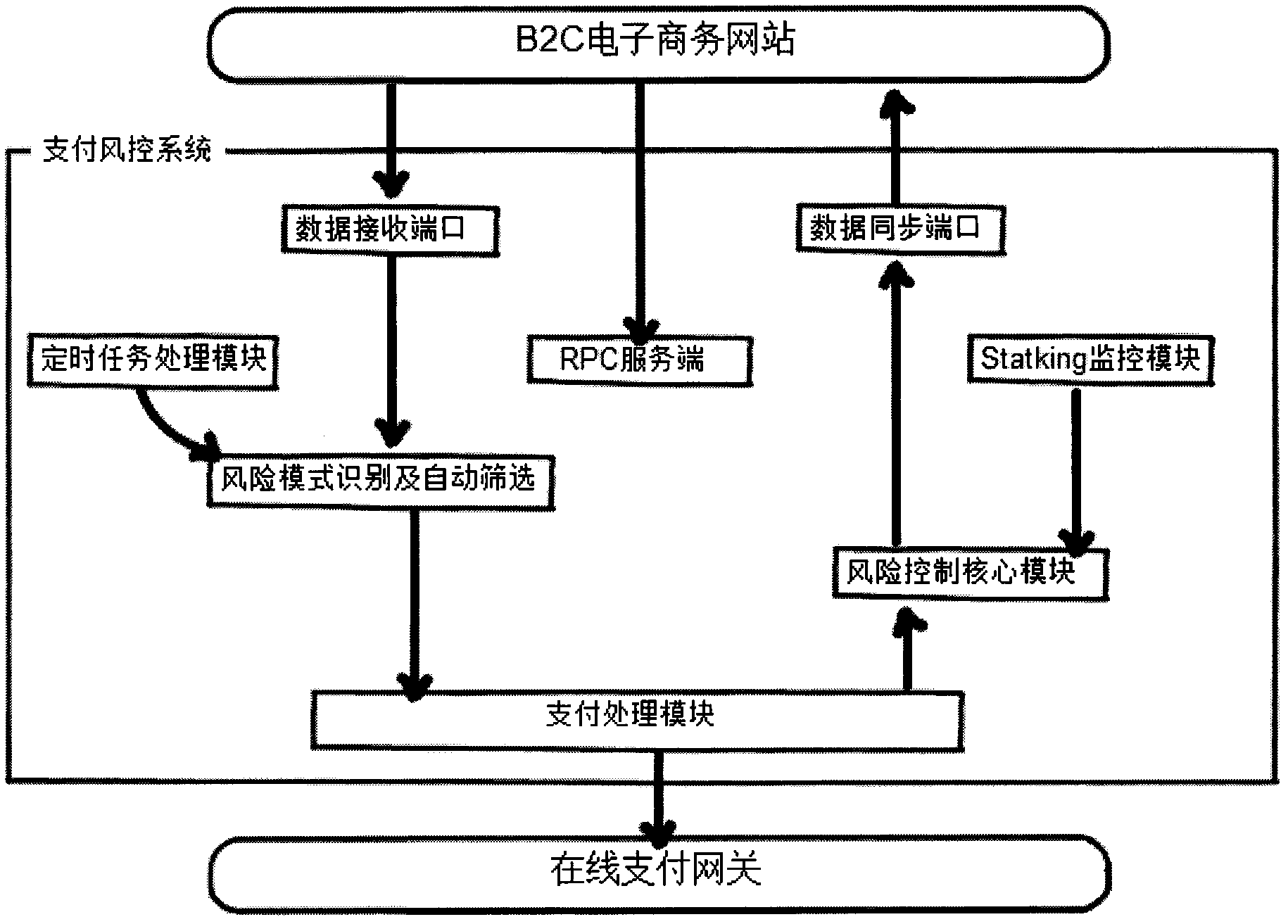

System for risk control over online payment

InactiveCN102194177AEffective controlEnsure safetyPayment architectureData synchronizationData connection

The invention discloses a system for risk control over online payment. An electronic commerce website is subjected to data connection with an online payment gateway through the system; the system comprises a data receiving port, a risk pattern identifying and automatic screening module, a risk control core module, a payment processing module, a data synchronizing port and an RPC (Remote Procedure Call) server side and is used for finishing the payment risk control and online payment flow. After a user order is generated, the system can be used for automatically analyzing and distinguishing the user order and then determining whether the user order belongs to high-risk orders, suspicious orders or trust orders by integrating various elements. Aiming at credit-card fraud, order cancel and the like in the current electronic commerce transaction process, particularly in the foreign trade B2C (Business to Customer) industry, the risk control system disclosed by the invention establishes an identification model, can carry out automatic identification and screening and can be used for effectively controlling the online payment so as to reduce the collection risk of online payment.

Owner:NANJING COFREE SOFTWARE TECH

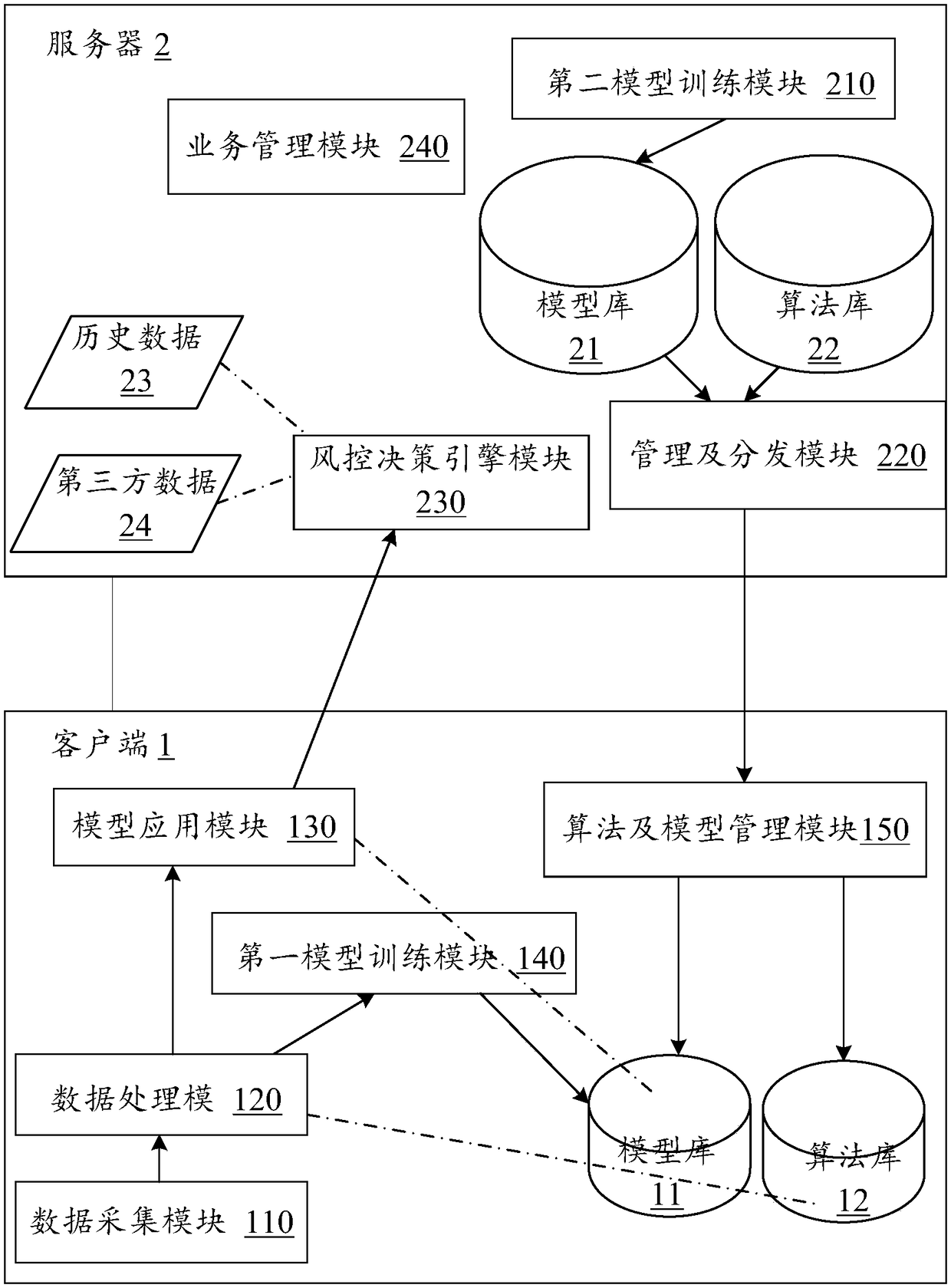

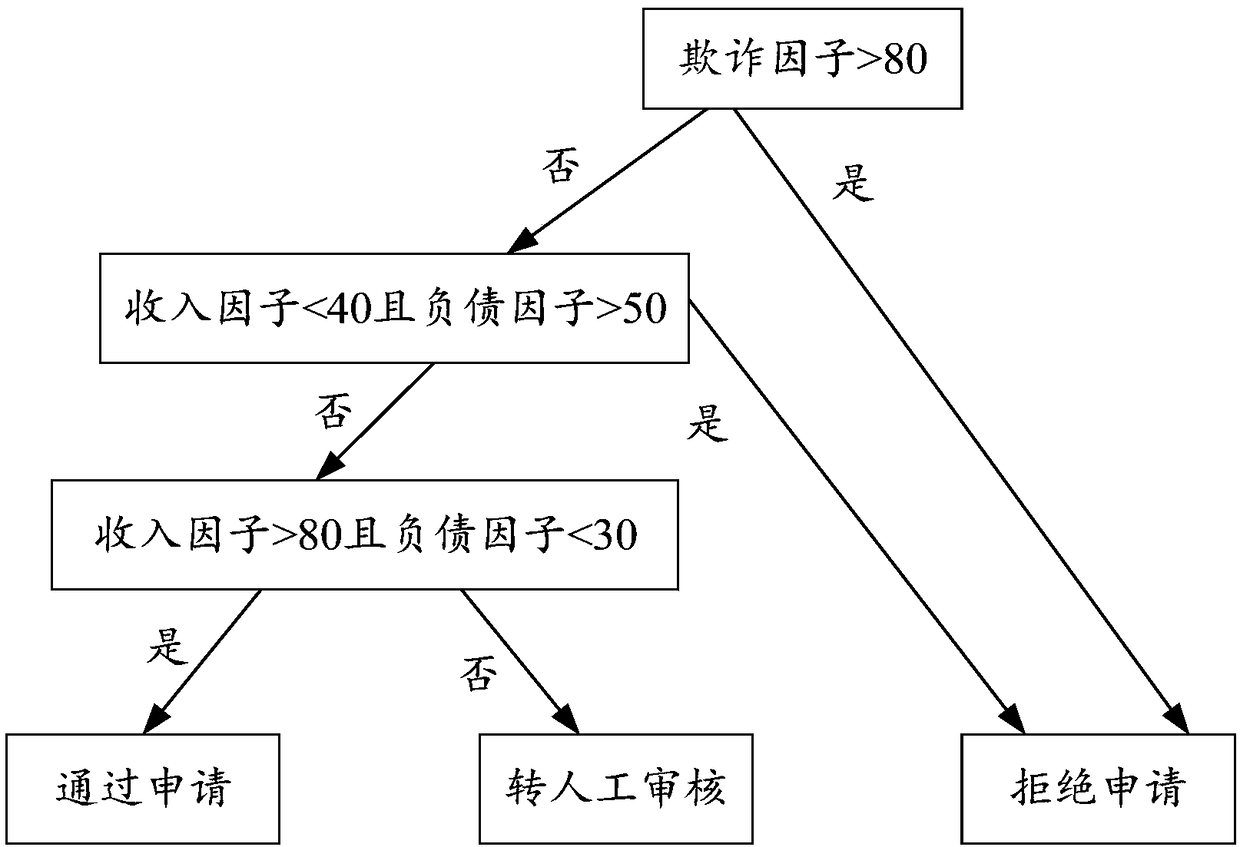

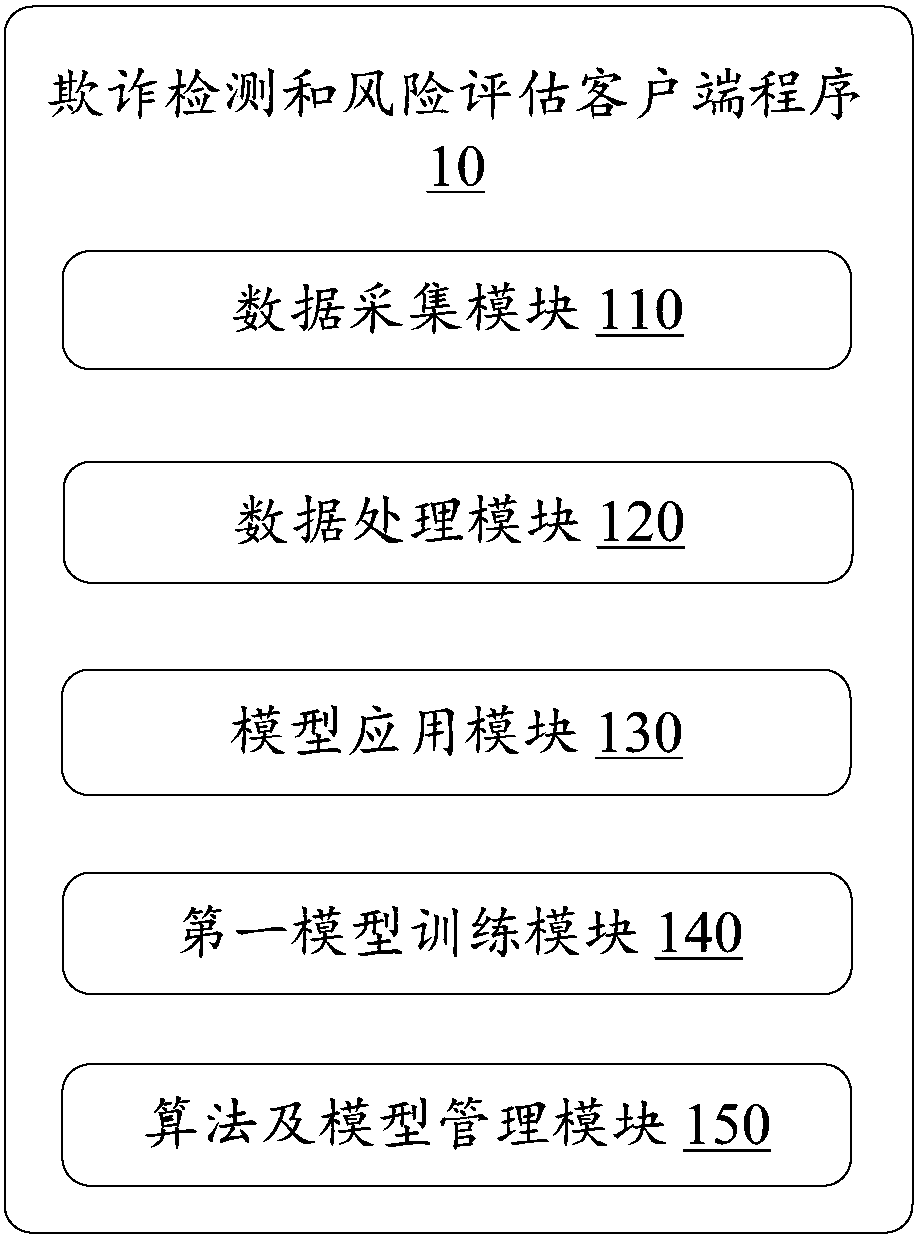

Fraud detecting and risk assessing method and system, equipment and storage medium

ActiveCN108596434AImprove experienceAlleviate the pressure of data transmissionEnsemble learningVersion controlRisk ControlData matching

The invention provides a fraud detecting and risk assessing method and system, equipment and a computer-readable storage medium. The method comprises the following steps of: collecting original data of a client user; extracting characteristic data from the original data by utilizing a data processing algorithm; inputting the characteristic data into a pre-trained machine learning model matched with the characteristic data, generating a model output result and uploading the model output result to a server; and outputting a fraud detecting and risk assessing result by utilizing a risk control decision engine and in combination with the model output result and historical data and third party data associated with the client user. By utilizing the method provided by the invention, the computingcapacity of client equipment can be fully utilized to reduce the computing pressure on the server; and a client does not need to upload the original data to the server, so that the data transmissionpressure between the client and the server and the risk of the leakage of privacy data and security information of the user can also be reduced.

Owner:WELAB INFORMATION TECH SHENZHEN LTD

Audit procedures and audit steps

An audit system includes a library of controls adapted to mitigate risks. A library of audit procedures is associated with the set of risk controls. Each audit procedure includes one or more actions that evaluate the effectiveness of an associated control. The audit system includes project templates for performing audit procedures associated with risk controls in a project management application. An audit project template can include standard audit procedures, document templates, and standard deliverables needed for an audit of an associated control. The project management application enables collaboration between auditors by providing planning functions, task assignment functions, progress tracking functions, communication functions, and document management functions. The library of audit procedures is included in a hosted audit service. Auditors access the hosted audit service to select controls from a control library, and the hosted audit service creates an audit procedures manual from the audit procedures associated with the selected controls.

Owner:ORACLE INT CORP

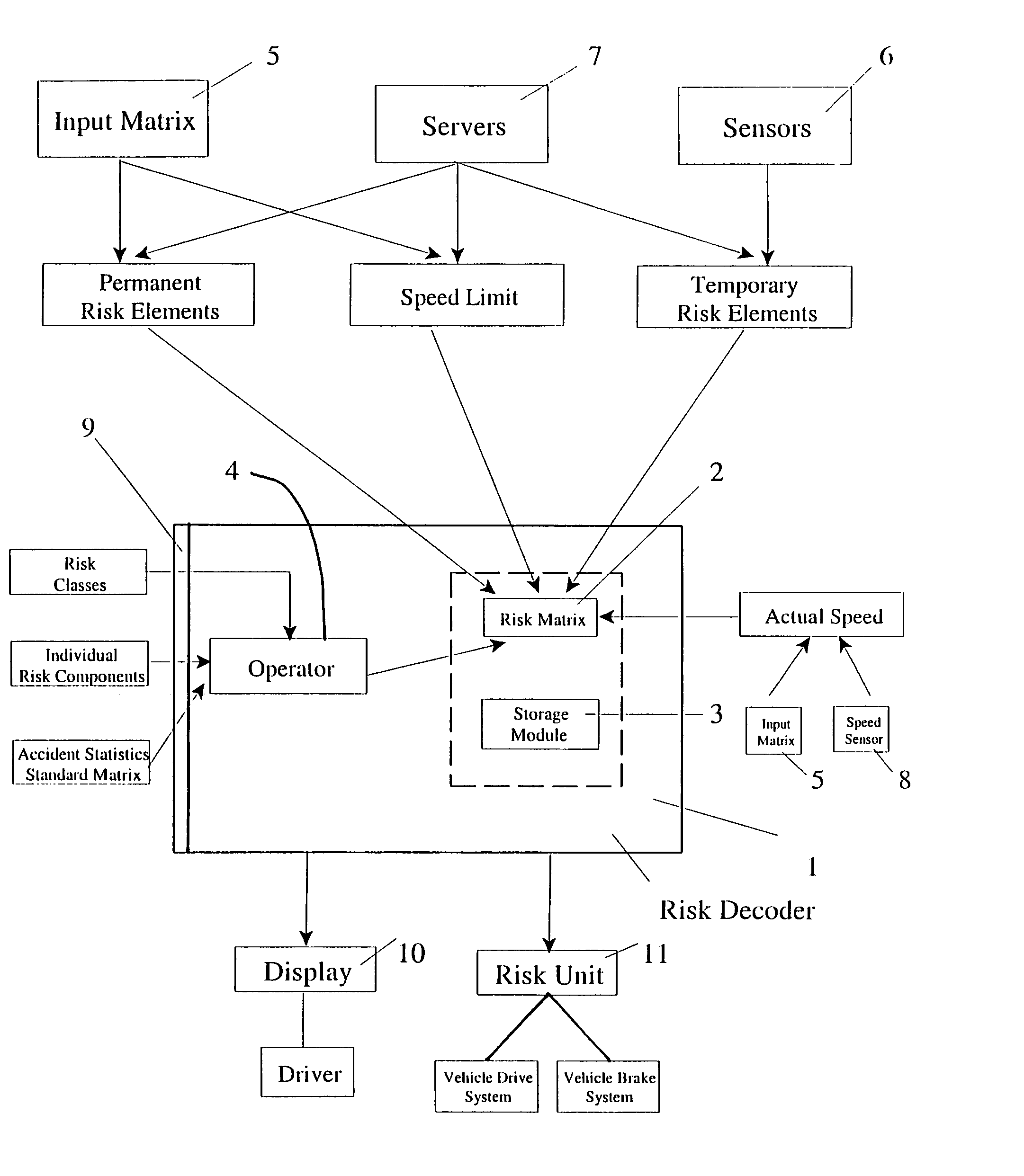

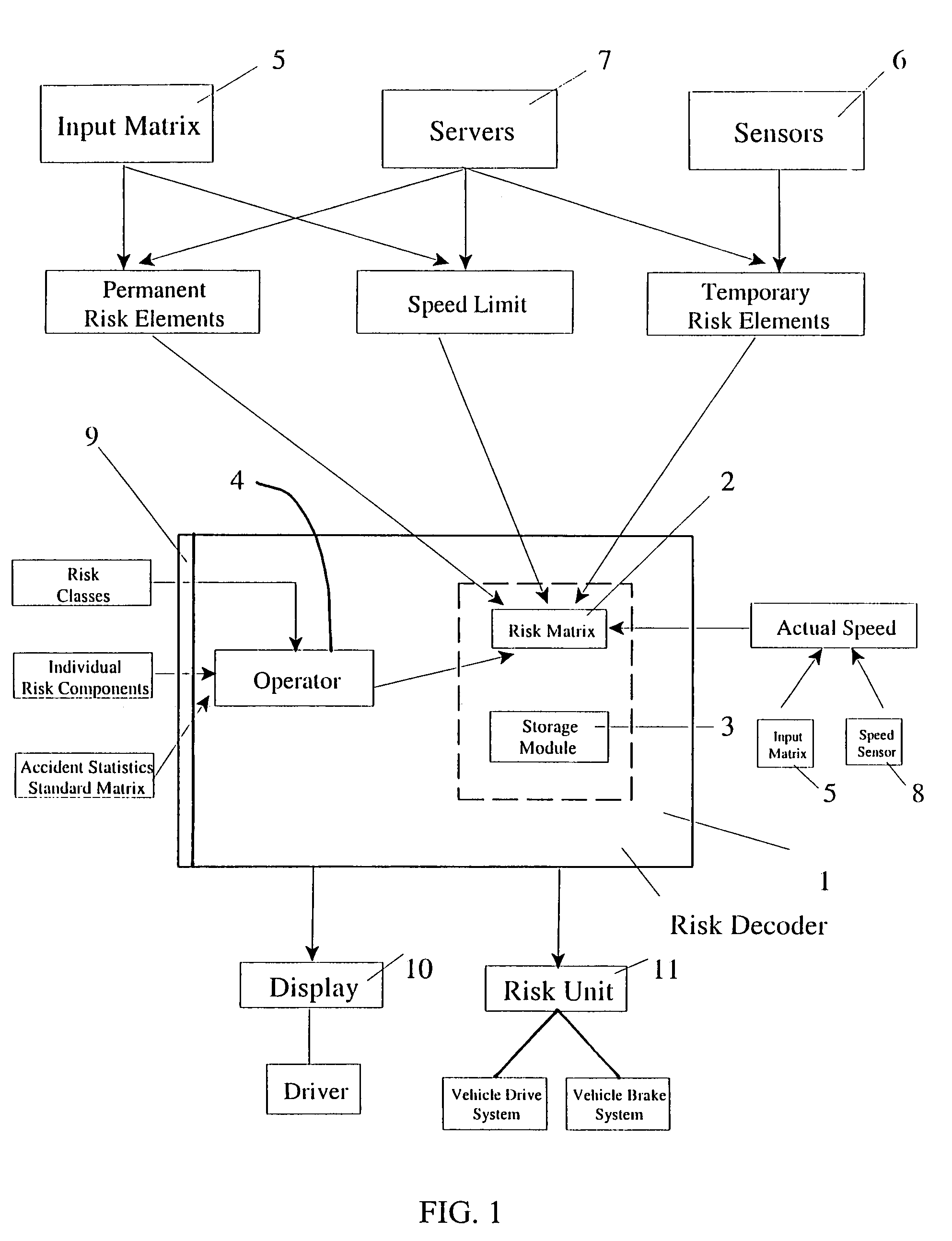

Method for controlling the speed of a motor vehicle in accordance with risk and system for carrying out the method

InactiveUS7167787B2Analogue computers for vehiclesInstruments for road network navigationRisk ControlMobile vehicle

A method controls the speed of a motor vehicle in accordance with risk. Each risk element of a road segment is evaluated for the specific risk potential thereof by taking into consideration the perils and the actual speed of the driver of the motor vehicle. An integral risk potential is calculated for the road segment on the basis of the sum of the specific risk potentials of all detected risk elements. A system is provided to carry out the method of the invention.

Owner:BASTIAN DIETER +1

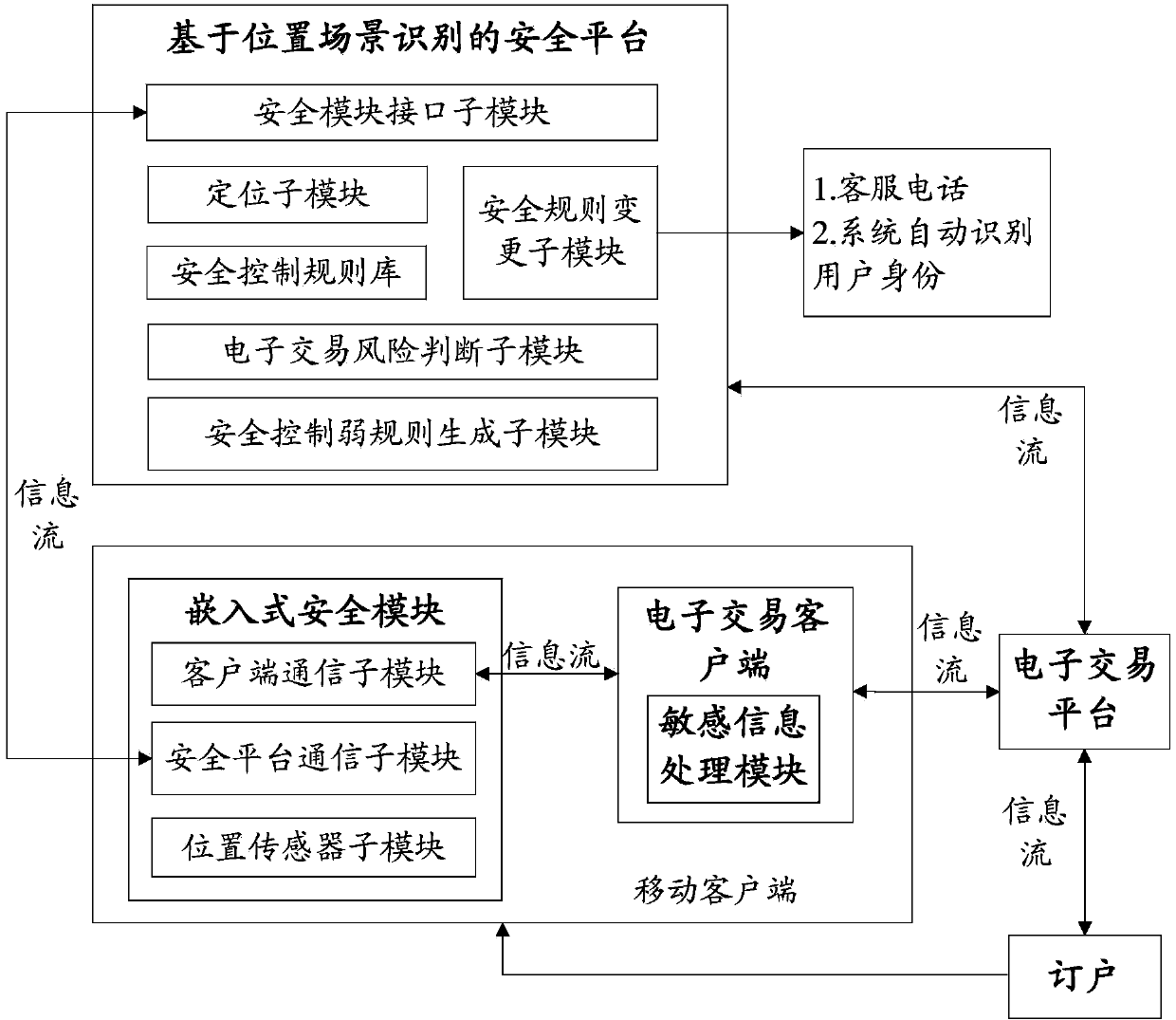

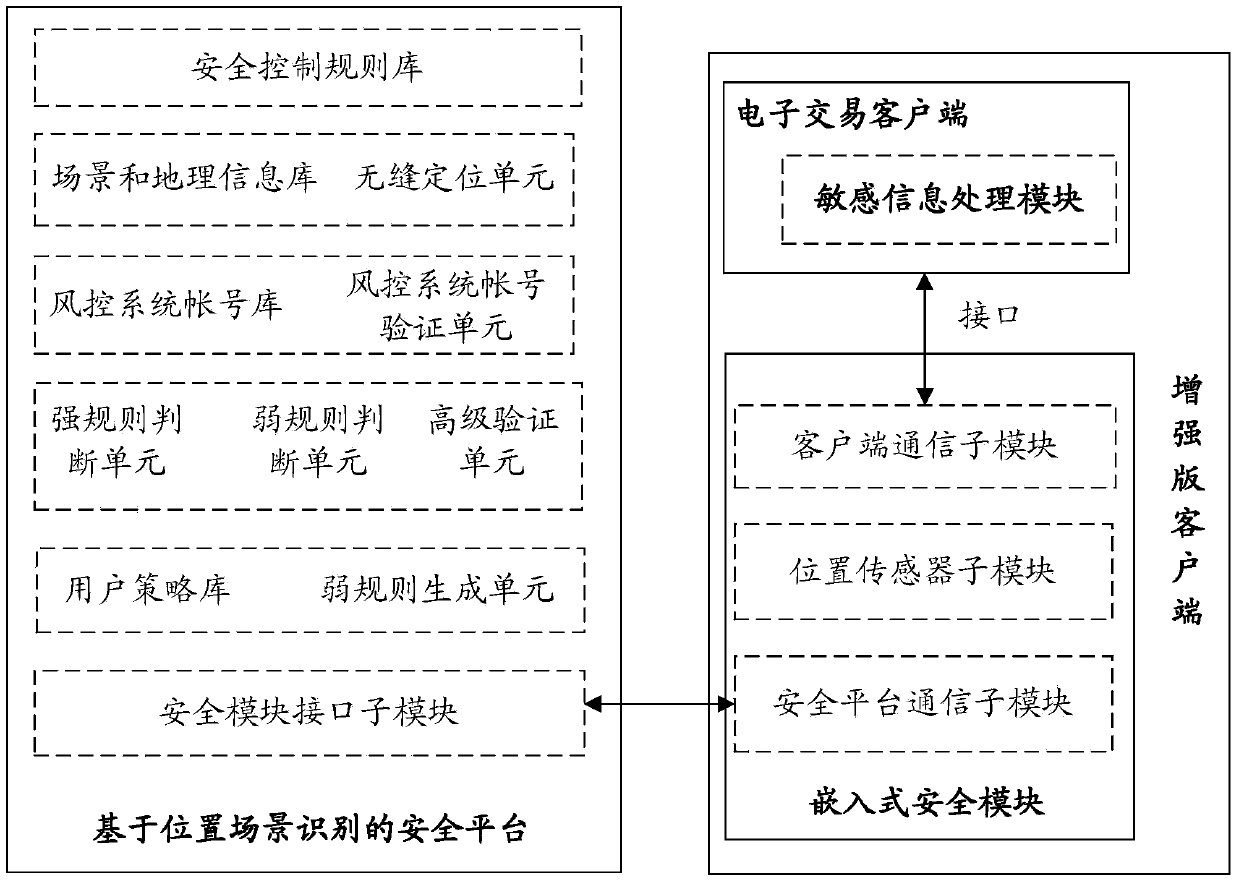

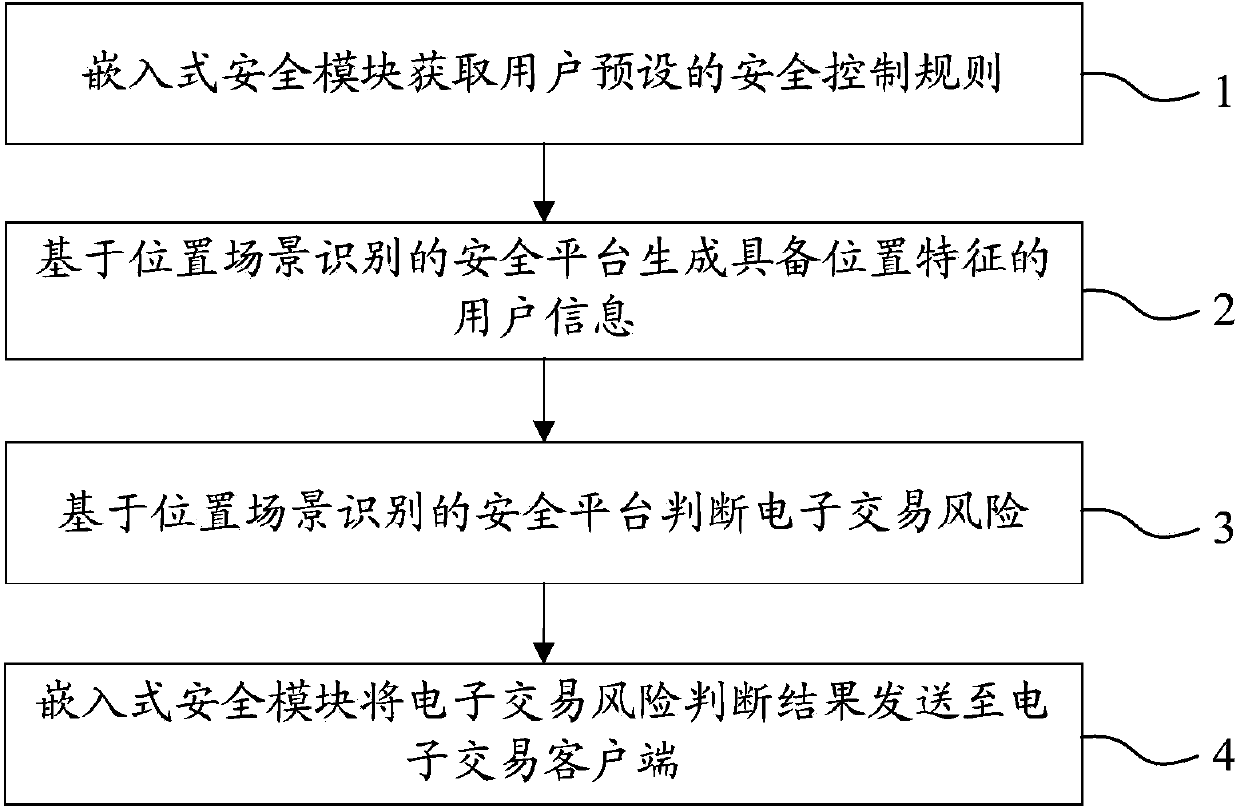

System and method for realizing electronic transaction risk control based on position scene identification

InactiveCN103745397APrevent fraudReduce personal property damageFinanceBuying/selling/leasing transactionsRisk ControlEmbedded security

The invention relates to a system for realizing electronic transaction risk control based on position scene identification. The system comprises a position scene identification-based security platform and an embedded security module, wherein the position scene identification-based security platform comprises a security interface sub-module, a positioning sub-module, a security control rule library, a security rule change sub-module, an electronic transaction risk judging sub-module and a security control weak rule generation sub-module, which are communicated with the embedded security module. The invention further relates to a method for realizing electronic transaction risk control based on position scene identification through the system. By adopting the system and the method for realizing electronic transaction risk control based on position scene identification, risk control over the electronic transactions of a user can be realized by providing positioning service and identifying a user position scene, so that the security of an electronic transaction process is enhanced, and losses caused by transaction security problems are reduced. The method is easy, convenient, and wider in application range.

Owner:YINLIAN FINANCIAL INFORMATION SERVICE BEIJING CO LTD

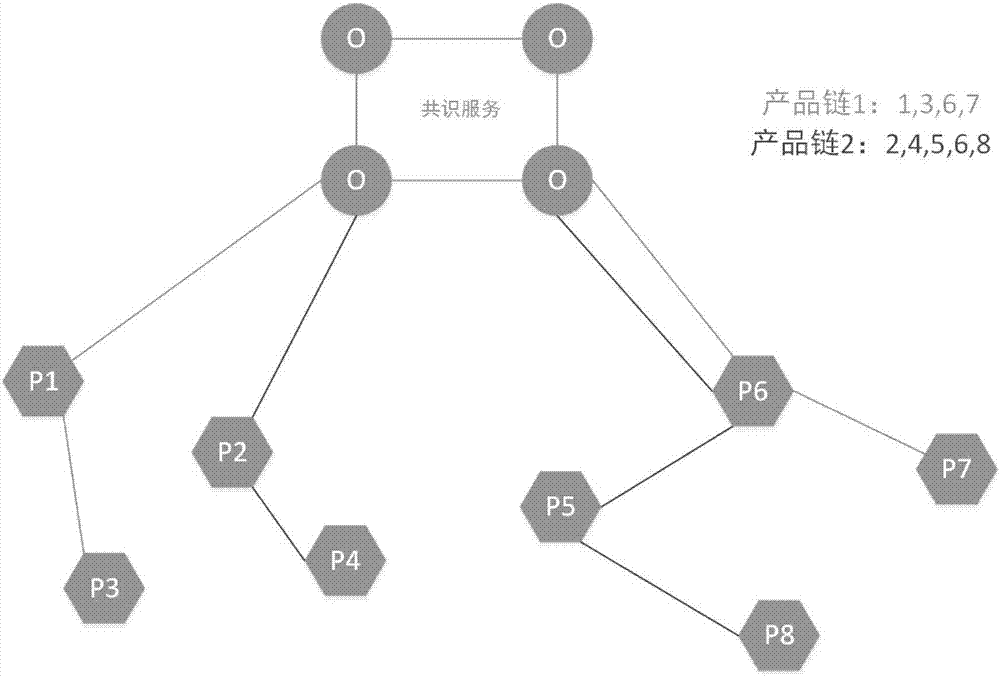

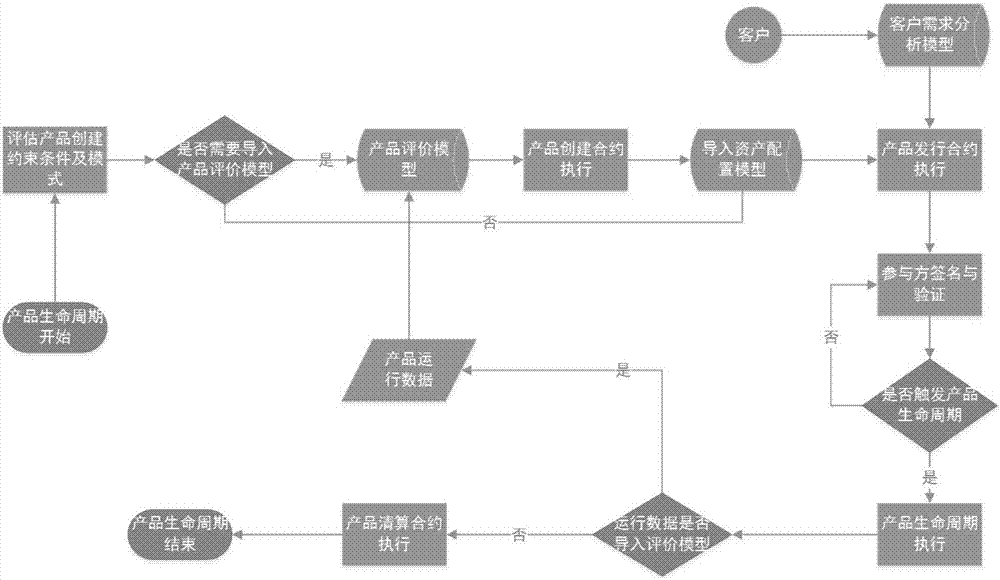

Intelligent investment product collocation method based on block chain intelligent contract technology

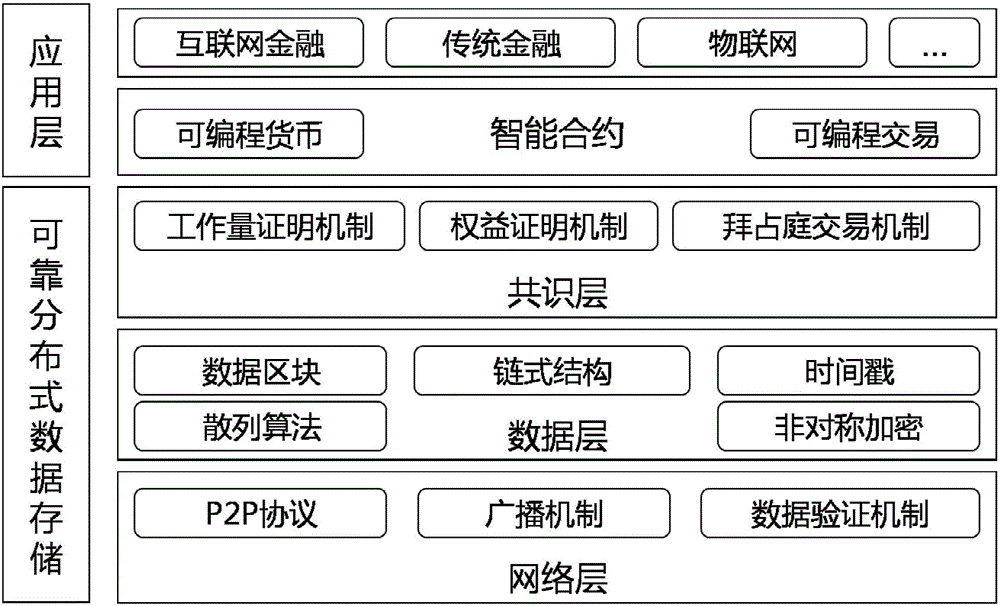

InactiveCN107578337AGuarantee authenticityProtection of rights and interestsFinanceRisk ControlTimestamp

The invention discloses an intelligent investment product collocation method based on the block chain intelligent contract technology. According to the method, the authenticity and non tamperability of the data on the chain are guaranteed by block chain consensus, authentication, timestamp and other technical means, and the participants on the chain can see the same and real information; the intelligent contract is automatically executed without artificial interference and supervision in the process of work can be performed to ensure the interests of customers. Being different from the centralized central registration and settlement mechanism, the system of the invention adopts the distributed technical architecture, the participants jointly maintain the product life cycle, thereby ensuring that the products are open and transparent and credible, effectively reducing the credit risk and avoiding the lack of supervision and risk control, resulting from that the product contents and operation means are opaque, and thus the customer rights and interests are not guaranteed.

Owner:HANGZHOU YUNXIANG NETWORK TECH

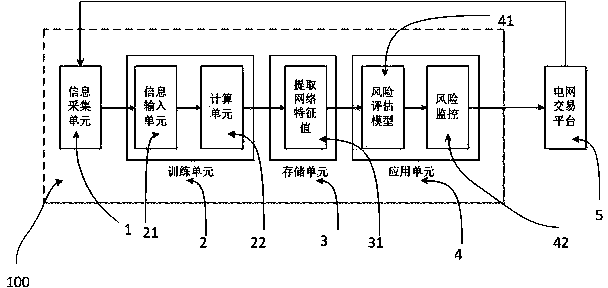

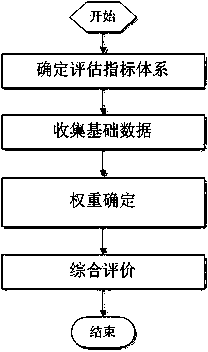

Risk control system and method

InactiveCN103514566AImprove user qualityQuality improvementFinanceBuying/selling/leasing transactionsRisk ControlControl system

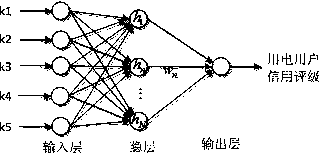

The invention provides risk control system and method, wherein the system and the method are used for carrying out risk monitoring on transaction data in an electric power transaction platform. The method comprises the steps that (1) an evaluation index system is determined according to properties, characteristics and evaluation purposes of an evaluated object, wherein classification and hierarchy of the evaluation index, specific setting of the evaluation index and the determination of an evaluation standard are comprised; (2) basic data are collected, wherein relevant data of the evaluated object are collected according to the setting of the evaluation index, and the index is pretreated; (3) weight determination is carried out, and weight is given to the index; (4) and comprehensive evaluation is carried out, wherein scoring and grading are carried out on all aspects and the overall credit condition of the evaluated object, so as to reflect the credit risk condition of the evaluated object. The system and the method solve the problems of high cost and poor effect of the risk monitoring method of the existing electric power transaction platform.

Owner:STATE GRID CORP OF CHINA +2

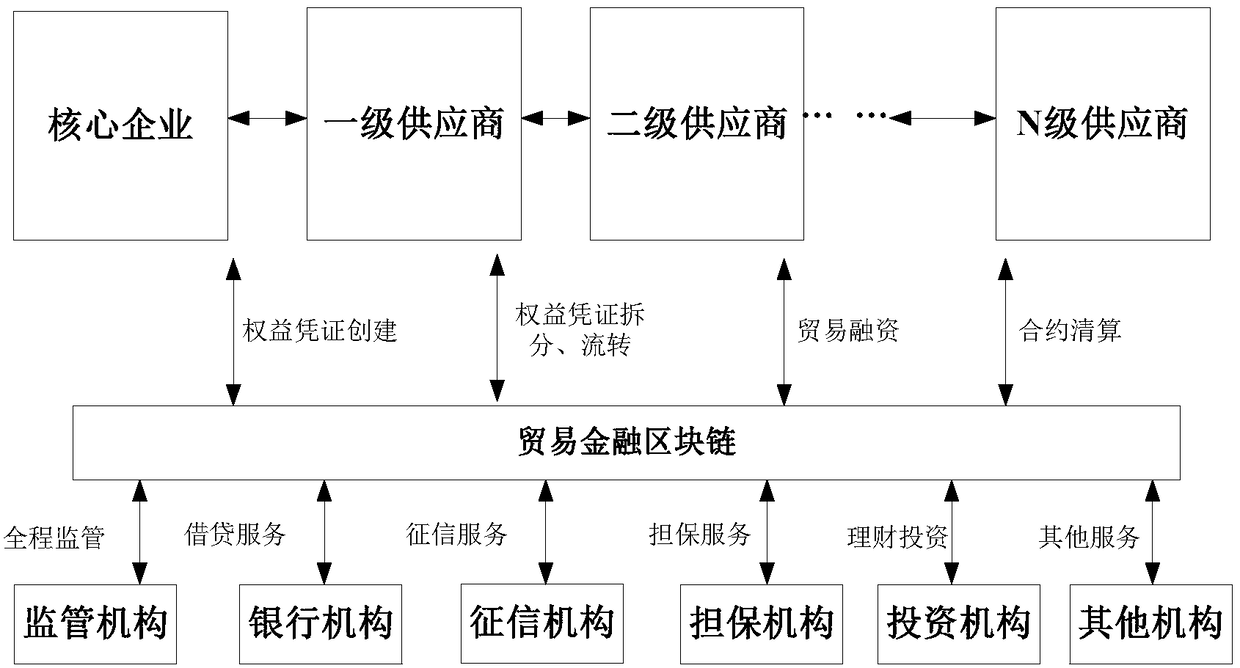

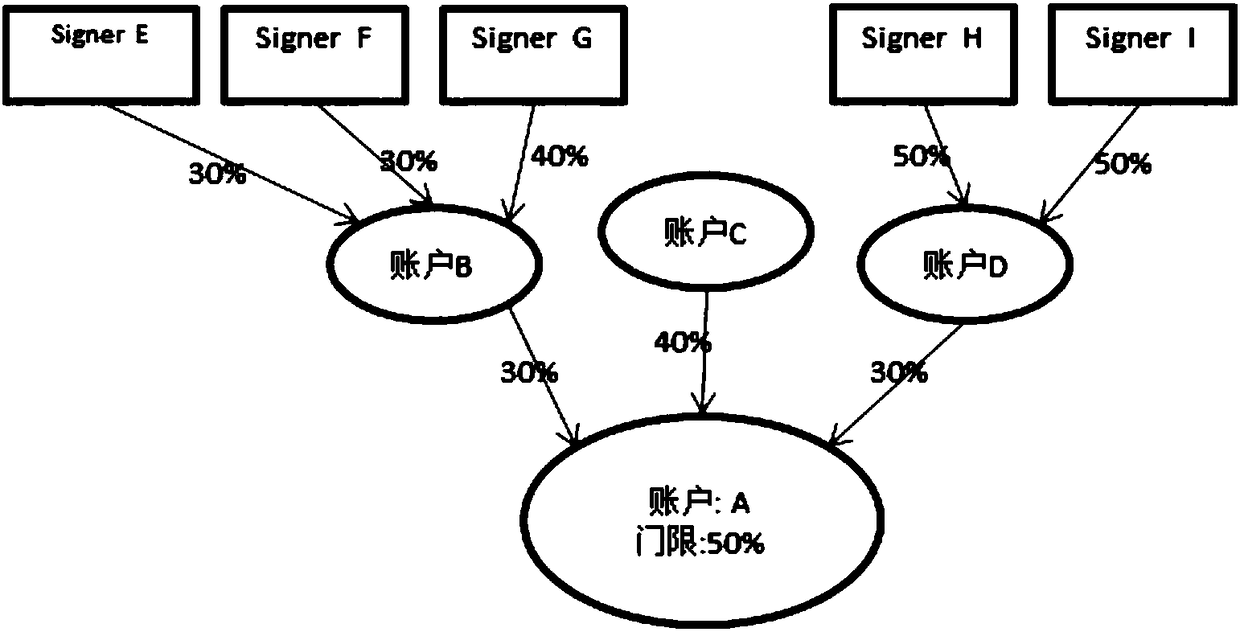

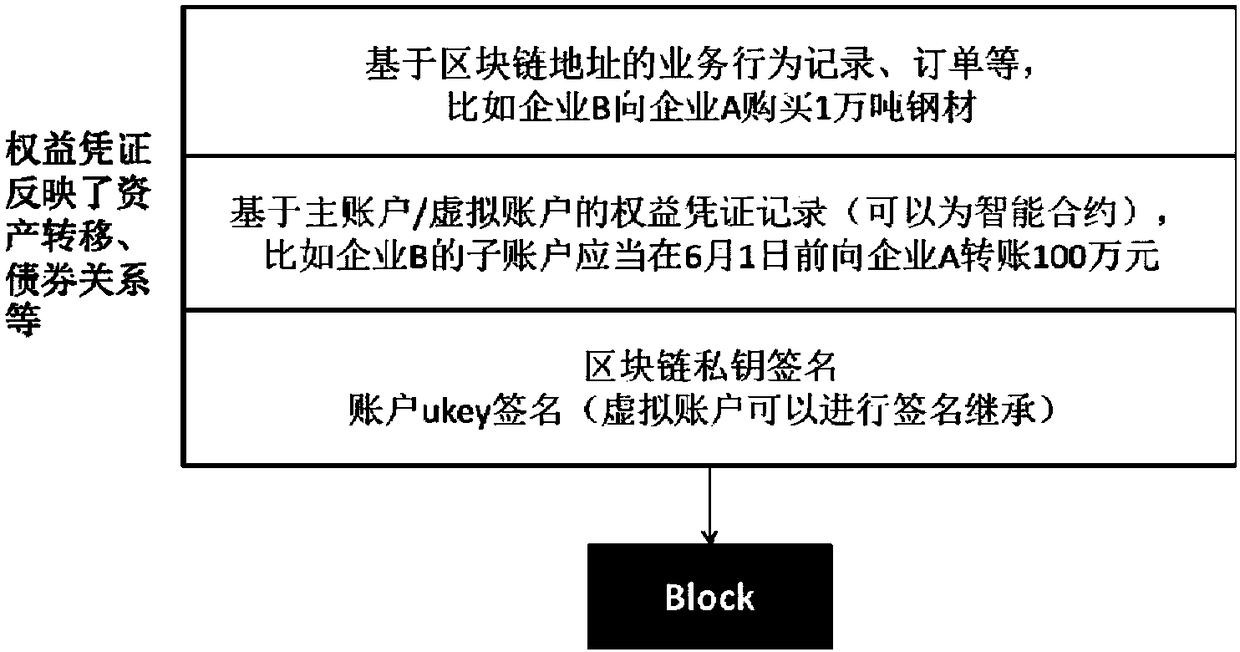

Trade financing methods and systems on distributed ledger

ActiveCN108428122APrevent crashImprove execution efficiencyFinancePayment protocolsRisk ControlVoucher

The invention provides trade financing methods and systems on a distributed ledger. The methods and systems are based on block-chain technology. One of the methods includes: generating a right and interest voucher by a core enterprise; and splitting and transferring the right and interest voucher level by level among multi-level suppliers. Specifically, the core enterprise and the multi-level suppliers create distributed-ledger account numbers, and select certificates for login, and certificate signature verification is carried out by a service end of the distributed ledger; the core enterprise generates the right and interest voucher; the right and interest certificate is split and transferred level by level among the multi-level suppliers; trade financing is carried out on the basis of the right and interest voucher, and trade financing records are generated; and the core enterprise carries out asset transferring and encashment of the payer and the receivers according to contract contents in the right and interest voucher. According to the methods and systems, the financial trade system collapse problem is avoided, and trade processes are safer; financial trade process executionefficiency is improved, trade time delays are reduced, and processing costs are also reduced; risk control risks are effectively reduced; and robustness of a trade system is guaranteed.

Owner:BUBI BEIJING NETWORK TECH CO LTD +1

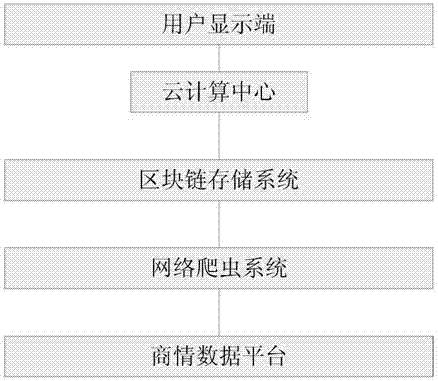

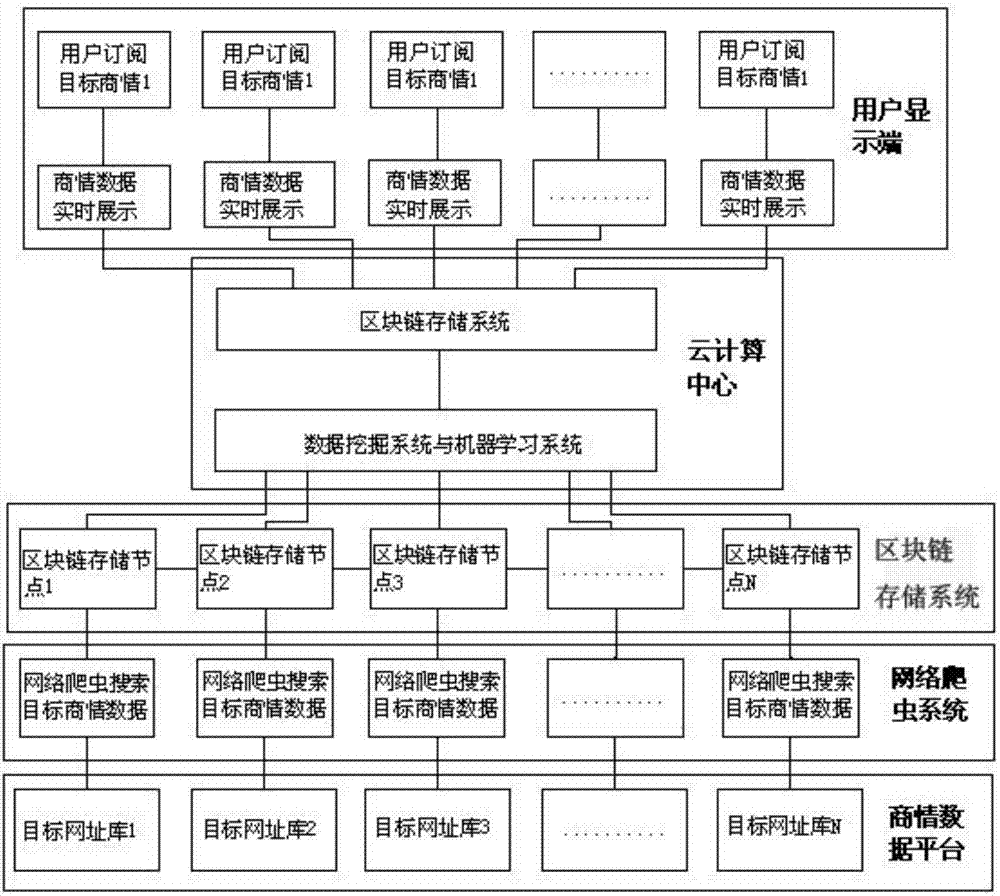

Blockchain big data business information analysis system

InactiveCN107103087AProtection of legitimate rights and interestsEffective mutual authenticationDigital data protectionSpecial data processing applicationsPersonalizationRisk Control

The invention discloses a blockchain big data business information analysis system. The system comprises a business information data platform, a web crawler system, a blockchain storage system, a cloud computing center and a user display side, the business information data platform and the web crawler system are subjected to information interaction, the blockchain storage system stores interaction information, the cloud computing center calls data from the blockchain storage system and processes the data, and a user transmits data processed in the cloud computing center to the user display side by operating the user display side; the business information analysis platform provides first-hand, special, detailed, accurate and personalized business information for the user in the first time. The system can be used in the fields of precision marketing, investment risk control, industrial economy development situation prediction, stock market prediction, enterprise credit evaluation, science and technology project application, market opportunity finding, automatic public opinion monitoring and the like.

Owner:CHENGDU ZHONGYUANXIN ELECTRONICS TECH

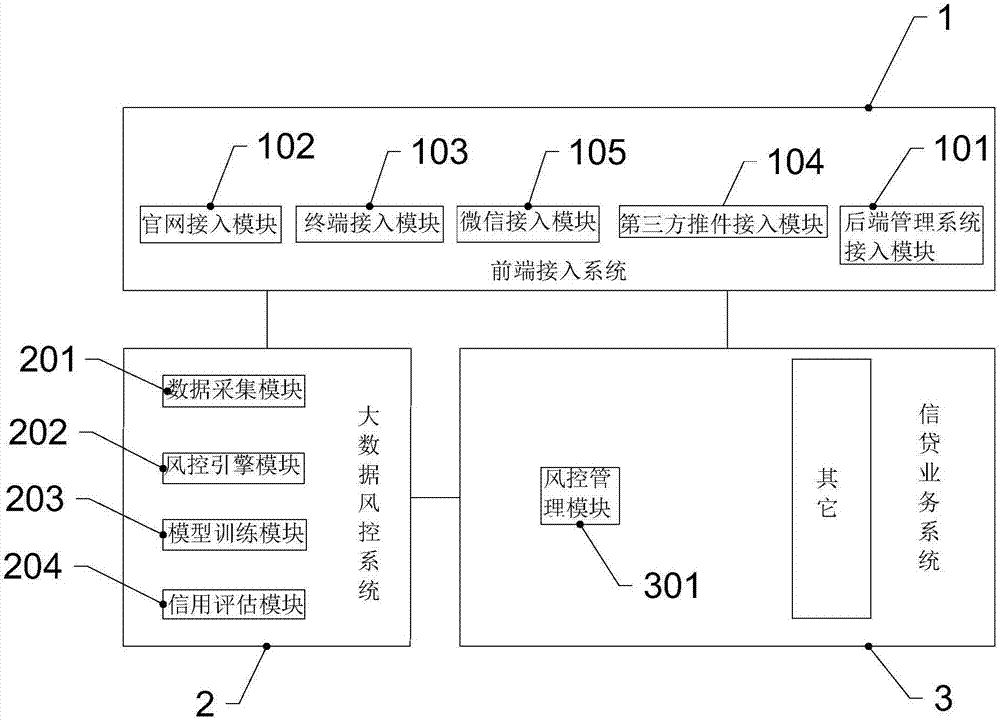

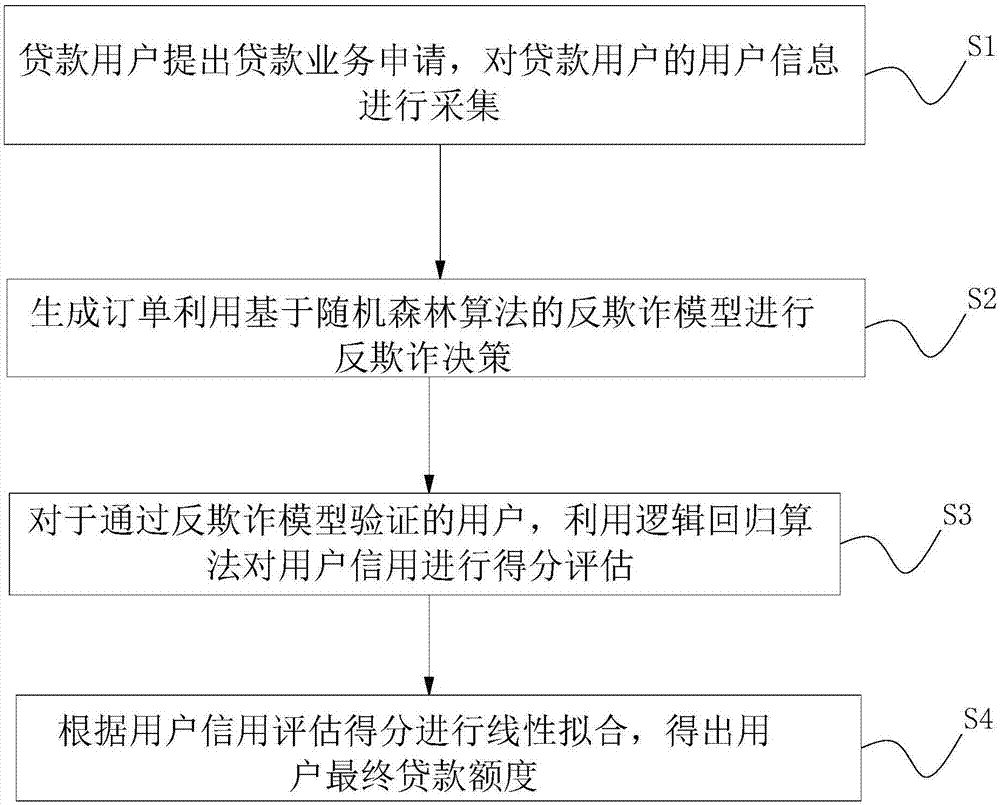

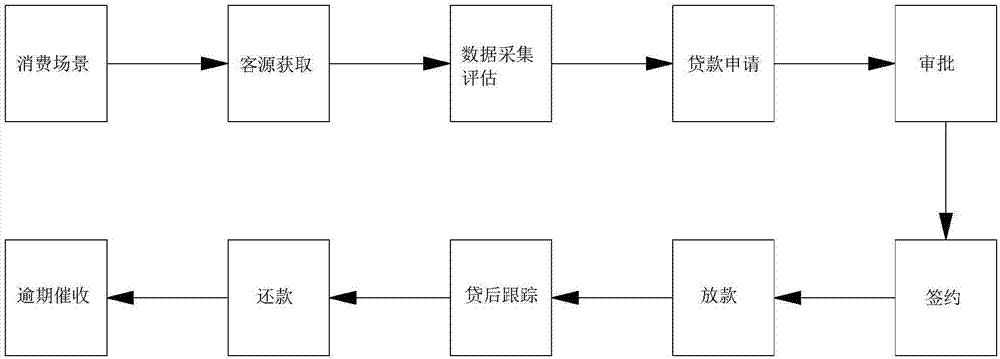

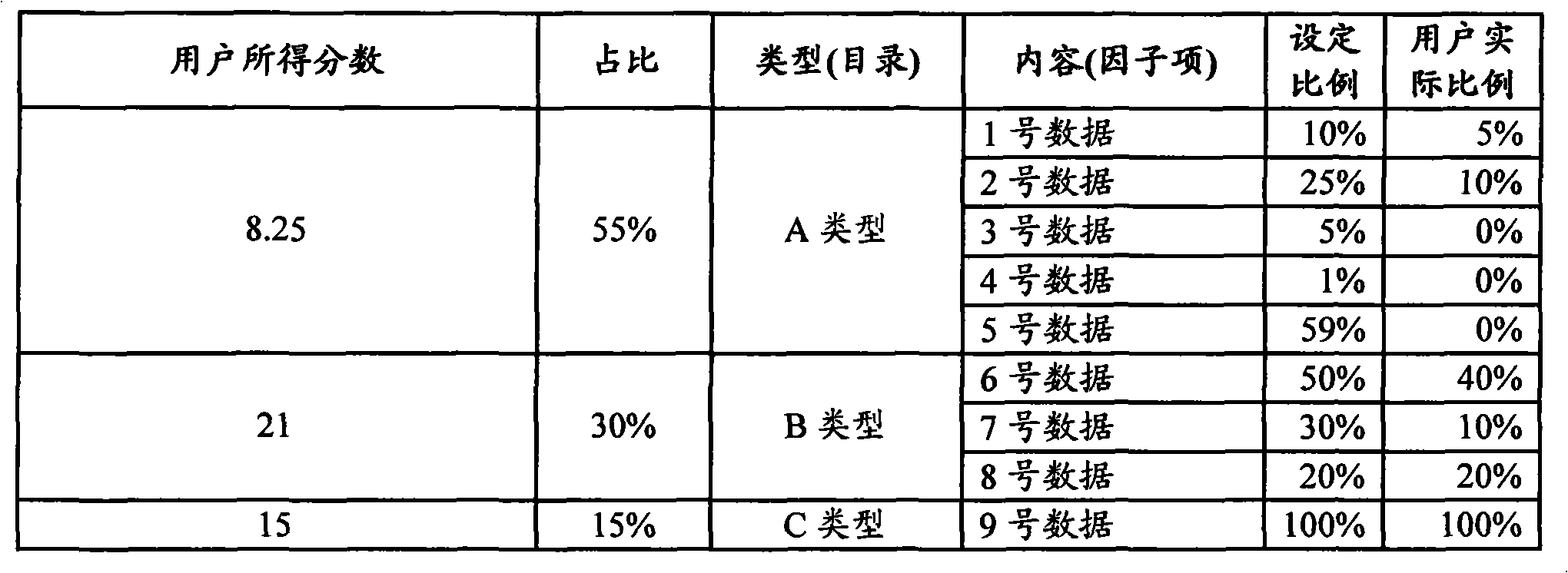

Microloan system based on big data intelligent risk control and microloan method thereof

The invention discloses a microloan system based on big data intelligent risk control and a microloan method thereof. The microloan system comprises a background management server which comprises a front-end access system, a big data risk control system and a loan service system. The big data risk control system comprises a data acquisition module, a risk control engine module, a model training module and a credit assessment module. The data acquisition module is used for collecting user data information and performing data preprocessing. The risk control engine module performs anti-fraud decision by using an anti-fraud model based on a random forest algorithm. The model training module is used for performing model optimization on the anti-fraud model through operation of at least two sample sets. The credit assessment module performs score assessment on the user credit by using a logic regression algorithm. The microloan system and the microloan method are fast in overall verification speed, comprehensive in data verification and high in risk anticipation accuracy so as to effectively reduce the microloan risk.

Owner:广州市触通软件科技股份有限公司

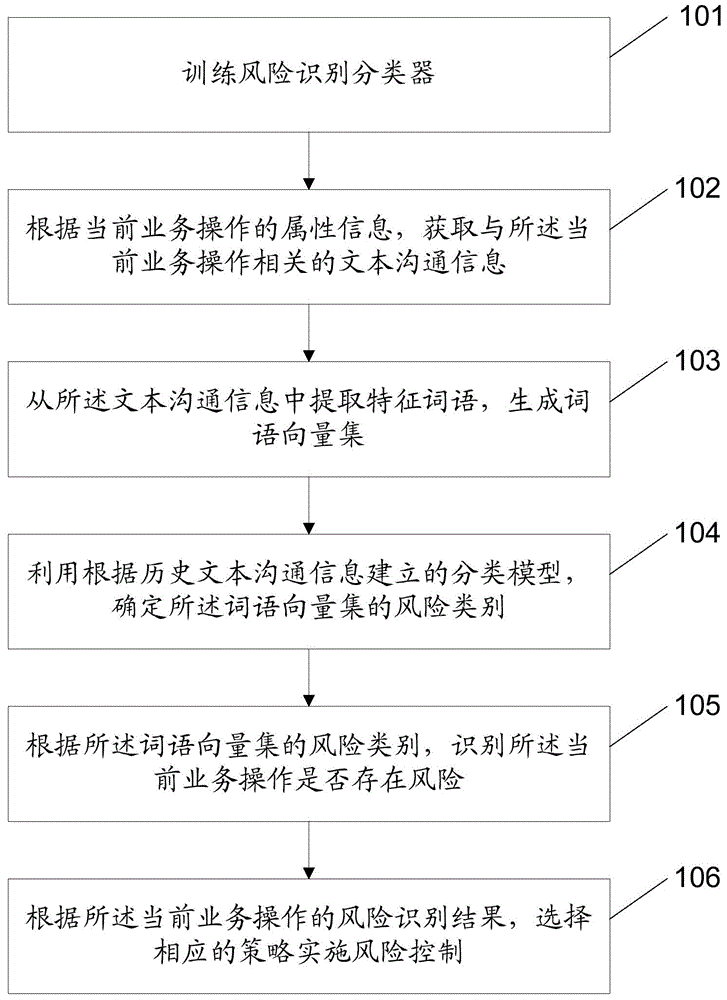

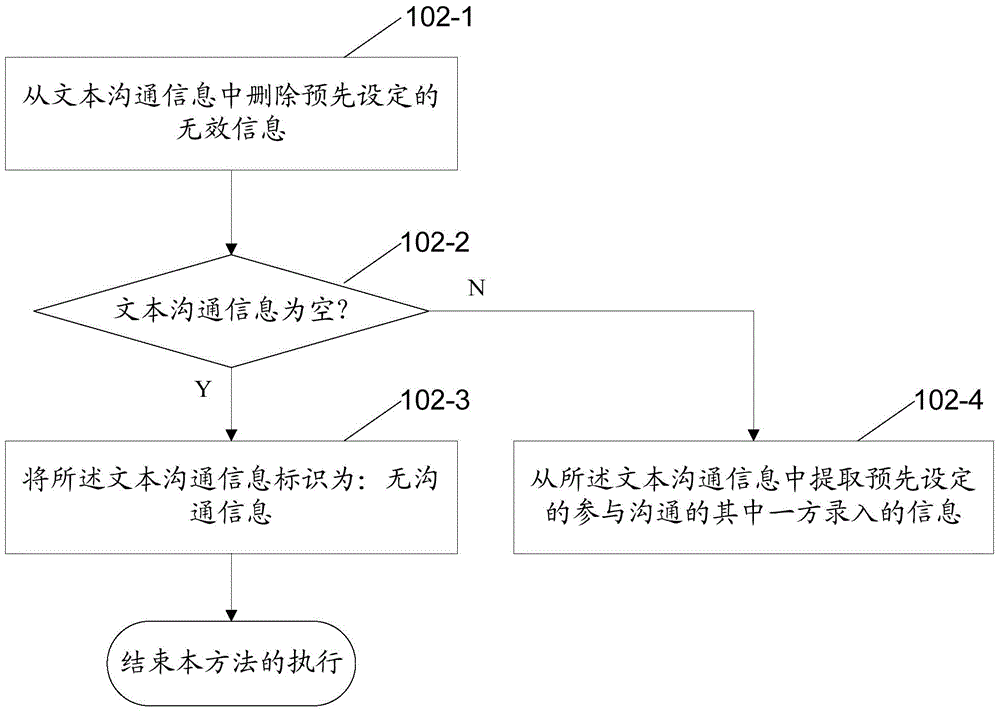

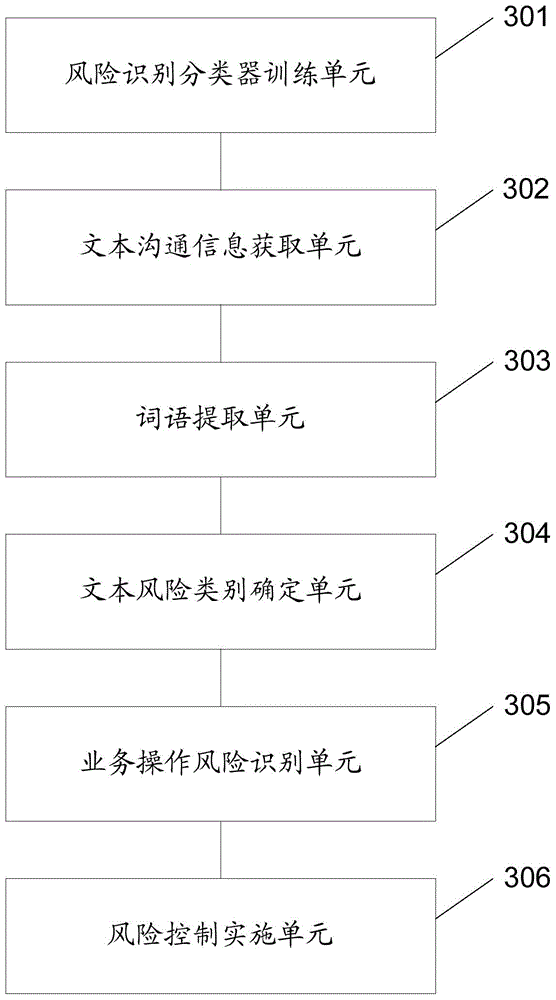

Risk identification method and device

InactiveCN106296195AGuaranteed accuracyEfficient identificationFinanceCharacter and pattern recognitionRisk ControlRisk identification

The application discloses a risk identification method comprising the following steps: acquiring text communication information related to a current service operation according to the attribute information of the current service operation; extracting feature words from the text communication information to generate a word vector set; determining the risk category of the word vector set using a classification model built according to historical text communication information; and identifying whether the current service operation is at risk or not according to the risk category of the word vector set. The application further provides a risk identification device. The method provides a new way of service operation risk identification. Through risk identification according to the text communication information related to the current service operation, a service operation which may be at risk can be identified efficiently, and a powerful reference is provided for the subsequent risk control link.

Owner:ADVANCED NEW TECH CO LTD

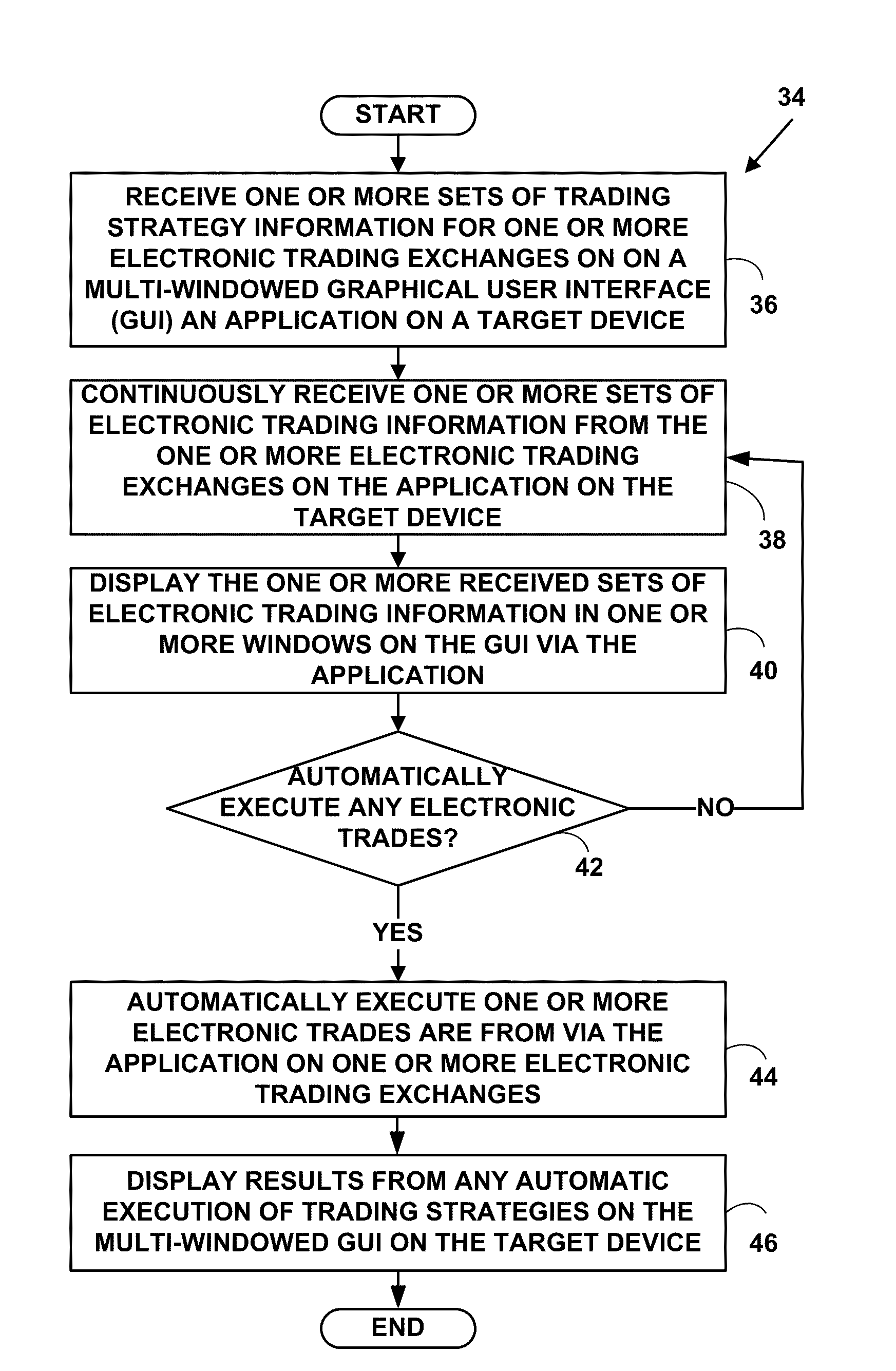

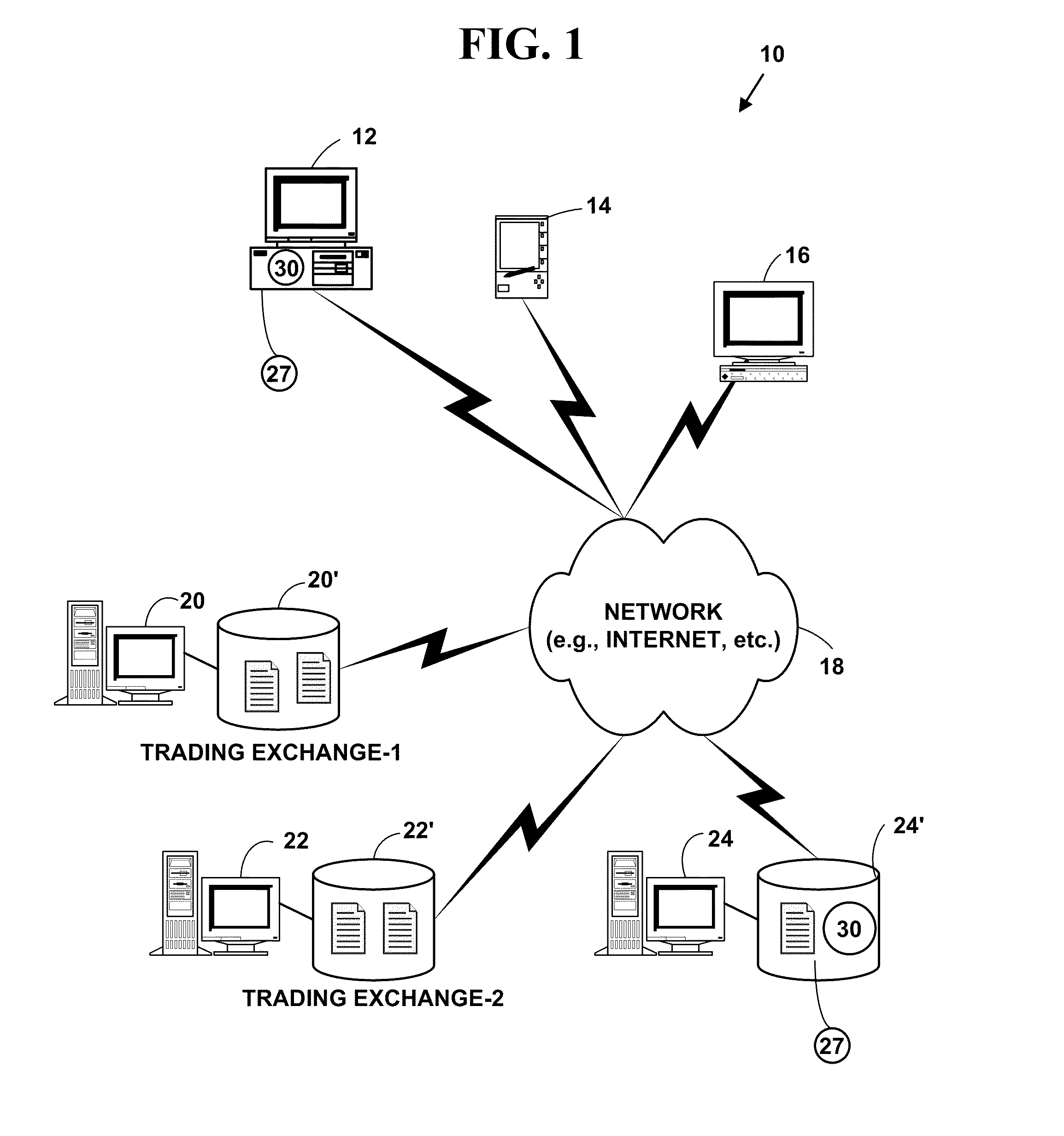

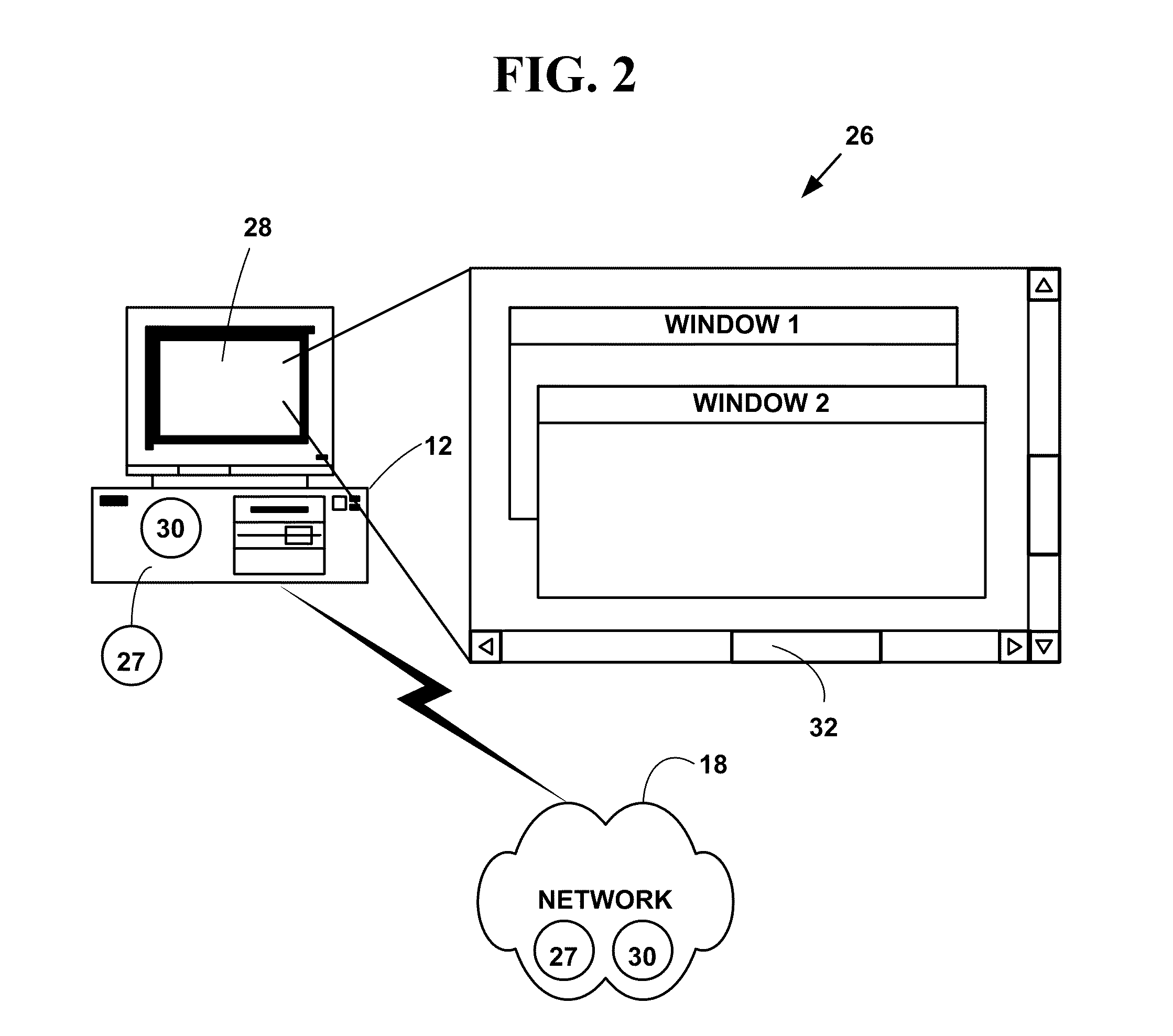

Method and system for automatically inputting, monitoring and trading risk- controlled spreads

A method and system for providing dynamic display of electronic trading information for trading risk-controlled spreads. The method and system allow spreads to be automatically inputted, executed, monitored and managed via plural different risk controls on one or more trading exchanges. The method and system provide automatic readjustment of desired market limit prices using one or more pre-determined spread trading risk factors and market depth information to maintain a desired price differential and a desired risk level for the automatic risk-controlled spread.

Owner:ROSENTHAL COLLINS GROUP

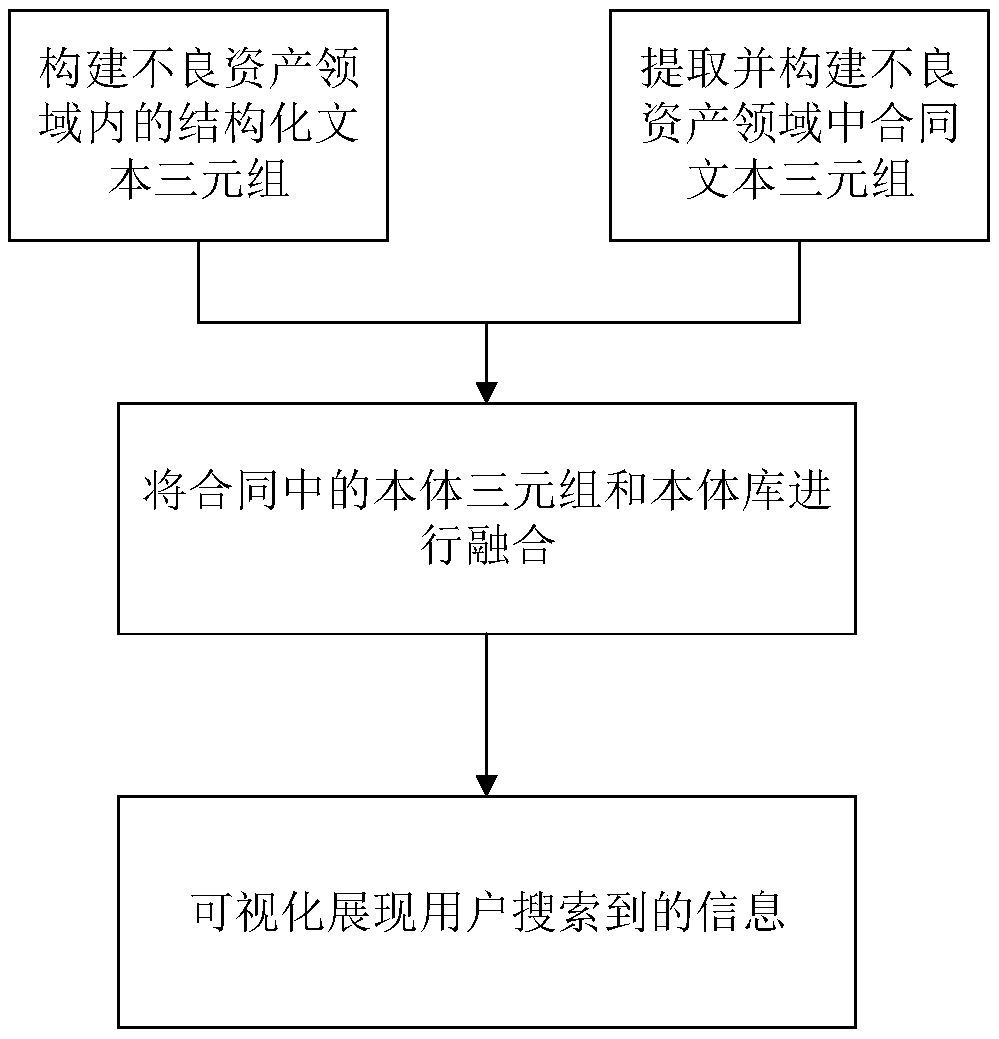

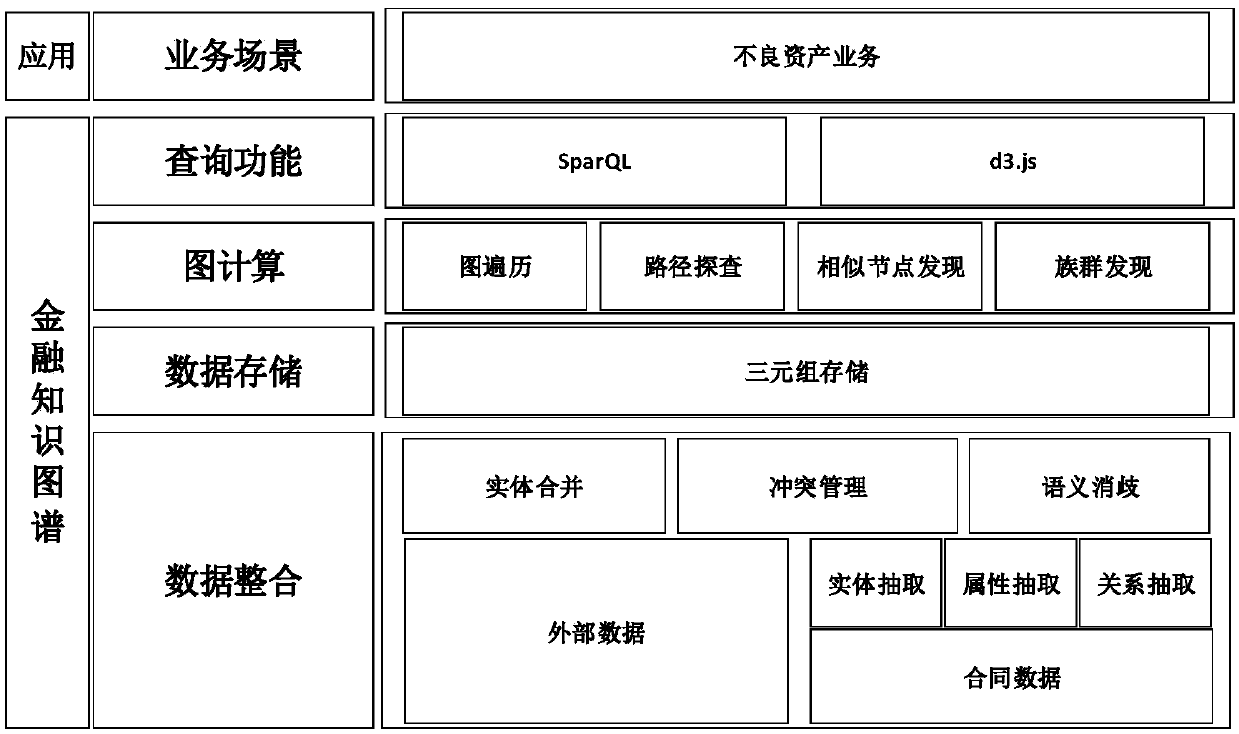

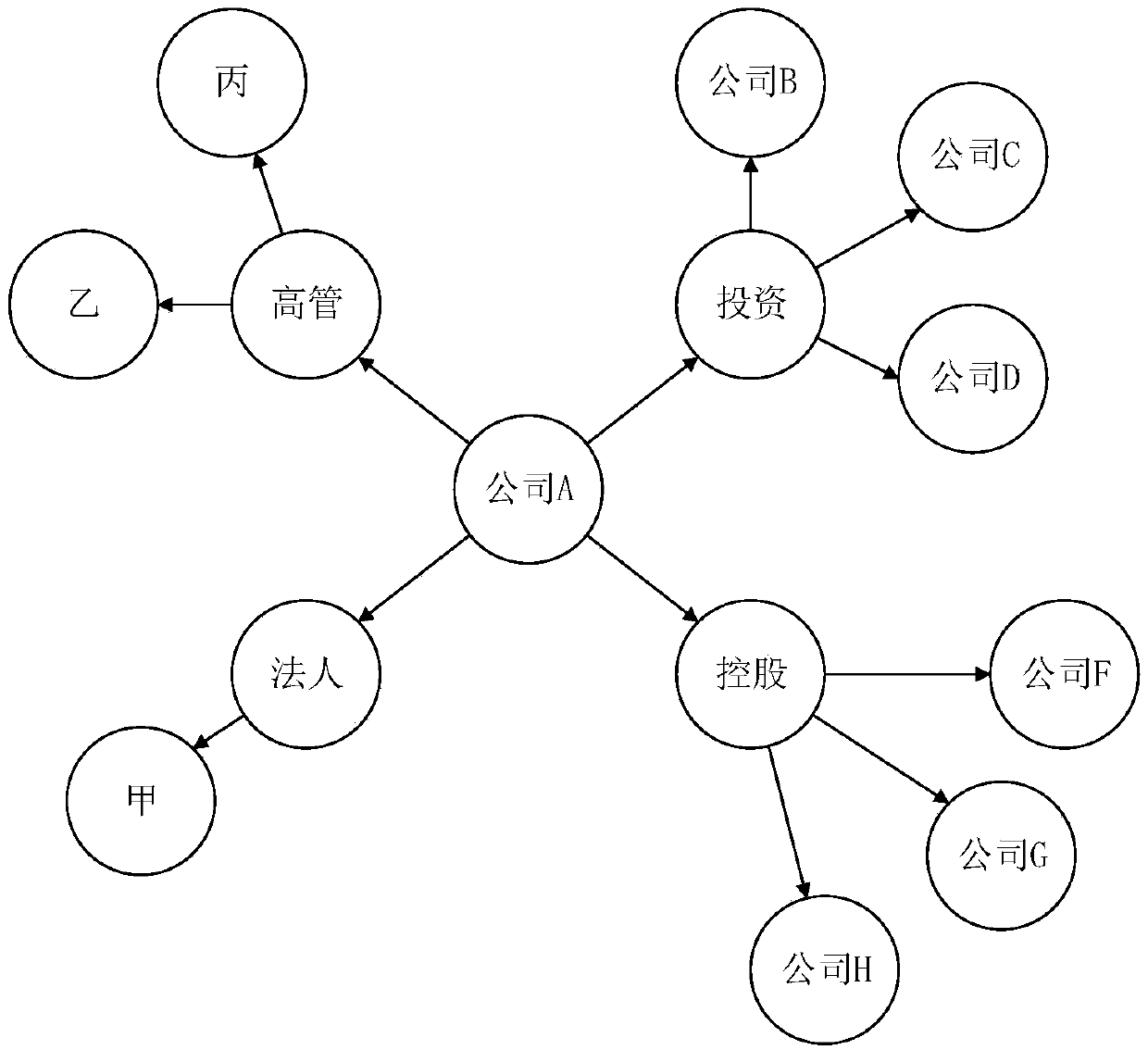

Method for constructing financial knowledge map in field of non-performing asset management

InactiveCN108932340AReduce the risk of inadequate accessRealize displayNatural language data processingSpecial data processing applicationsRisk ControlInformation visualization

The invention provides a method for constructing a financial knowledge map in the field of non-performing asset management. The method comprises: firstly, performing triple construction on structuredtexts in the field of non-performing asset management; secondly, intelligently extracting unstructured text information based on a semantic recognition model and constructing a triple, to realize structured extraction of unstructured texts; and then, performing data fusion on bodies in a contract, attributes of the bodies, and relations of body pairs with ontology base information, to fuse multi-source heterogeneous data and visually show information related to user search. Through the above steps, the method realizes knowledge reasoning, calculation and completion, so that complete, true, andeffective information is visually shown to business experts. The method is used to solve a problem that an enterprise and employees are lack of risk control decision support when conducting businessin the field of non-performing asset management.

Owner:华融融通(北京)科技有限公司

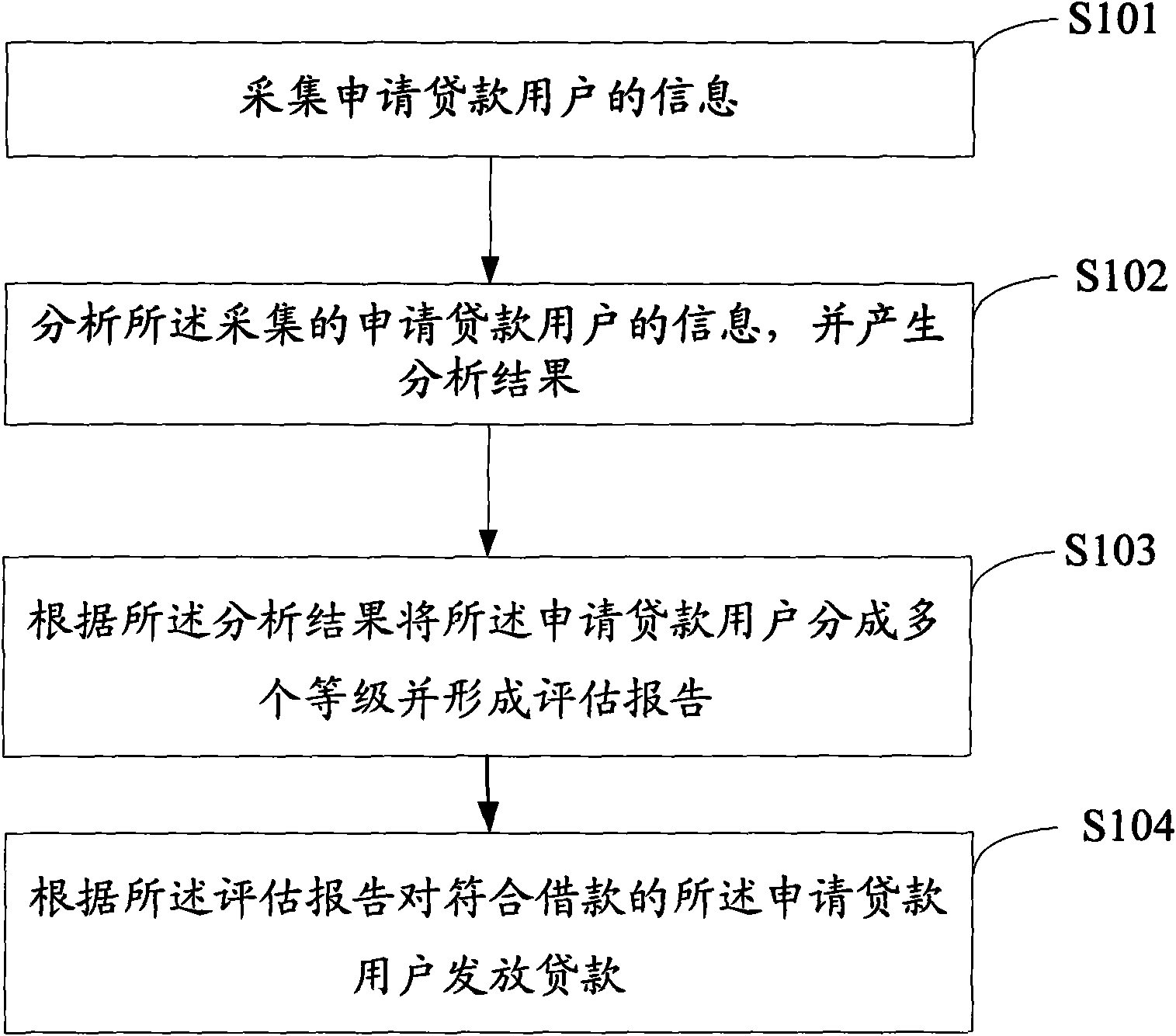

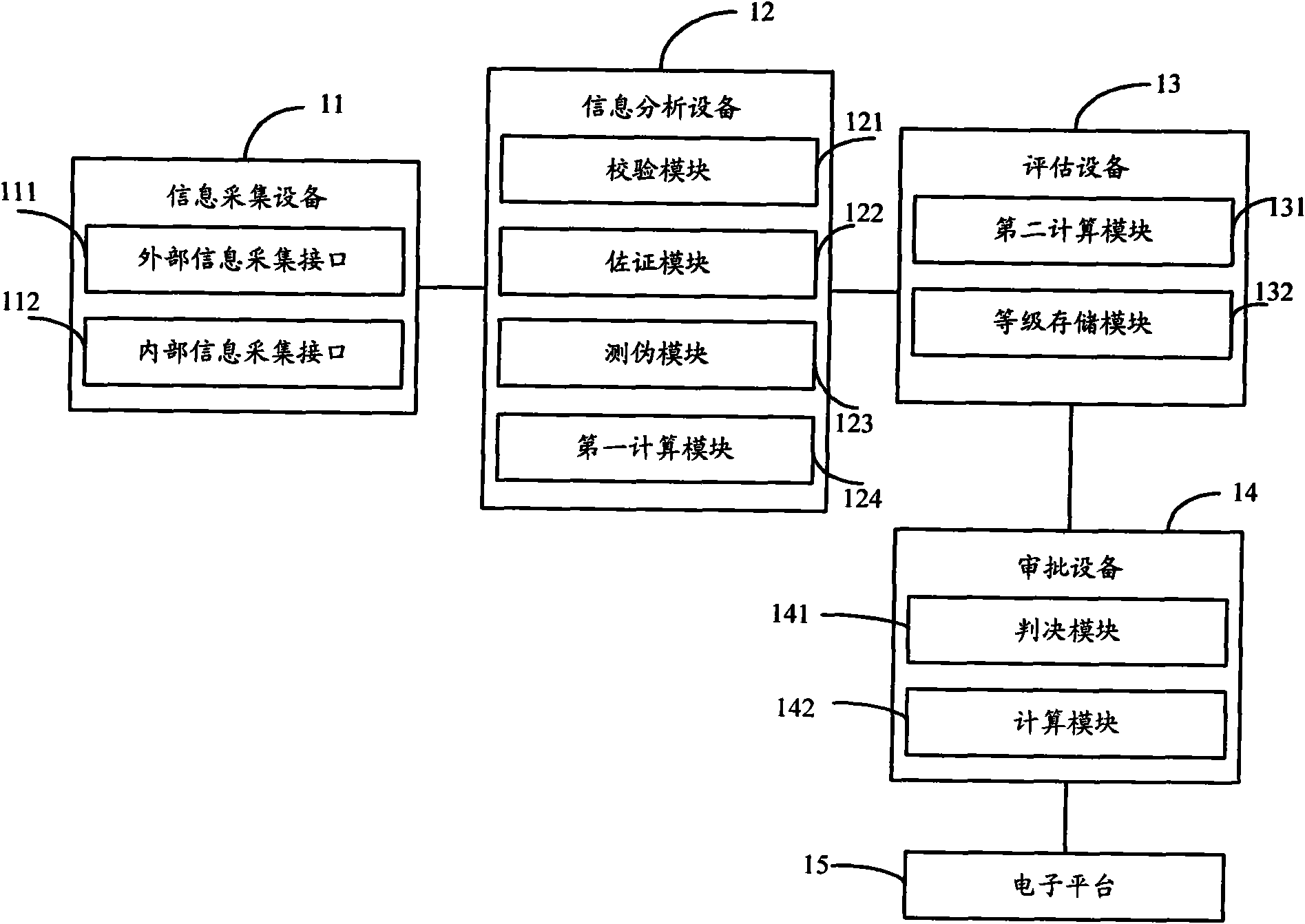

Loan permission assessment method and system

The embodiment of the invention provides a loan permission assessment method which comprises the following steps: acquiring information of users applying for loan; analyzing the acquired information of the users applying for loan and generating an analysis result; dividing the users applying for loan into a plurality of classes according to the analysis result and forming an assessment report; andoffering the loan for the user who applies for loan and accords with the loan according to the assessment report. In the embodiment of the invention, detail transaction data of enterprises in an e-commerce platform and various banks can be obtained through the transaction data in a network station, individual authentication information of entrepreneurs and dynamic data of the enterprises in the network station can be obtained and historical data of the enterprises in a loan management system or loan risk control system can be also directly obtained, thereby completely analyzing the enterprises, completing all loan flows on-line and having the advantages of rapid and simple operation and low cost.

Owner:ALIBABA GRP HLDG LTD

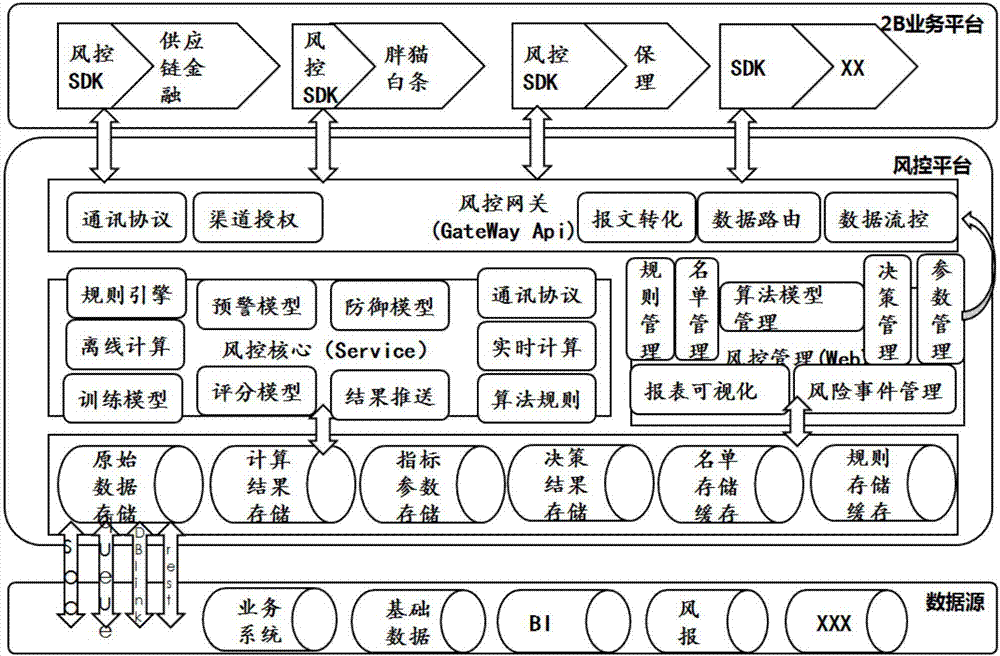

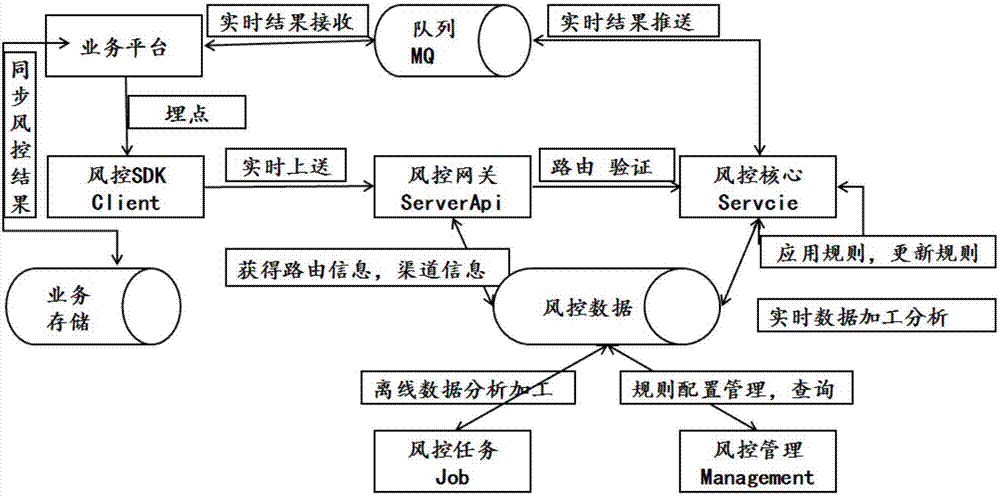

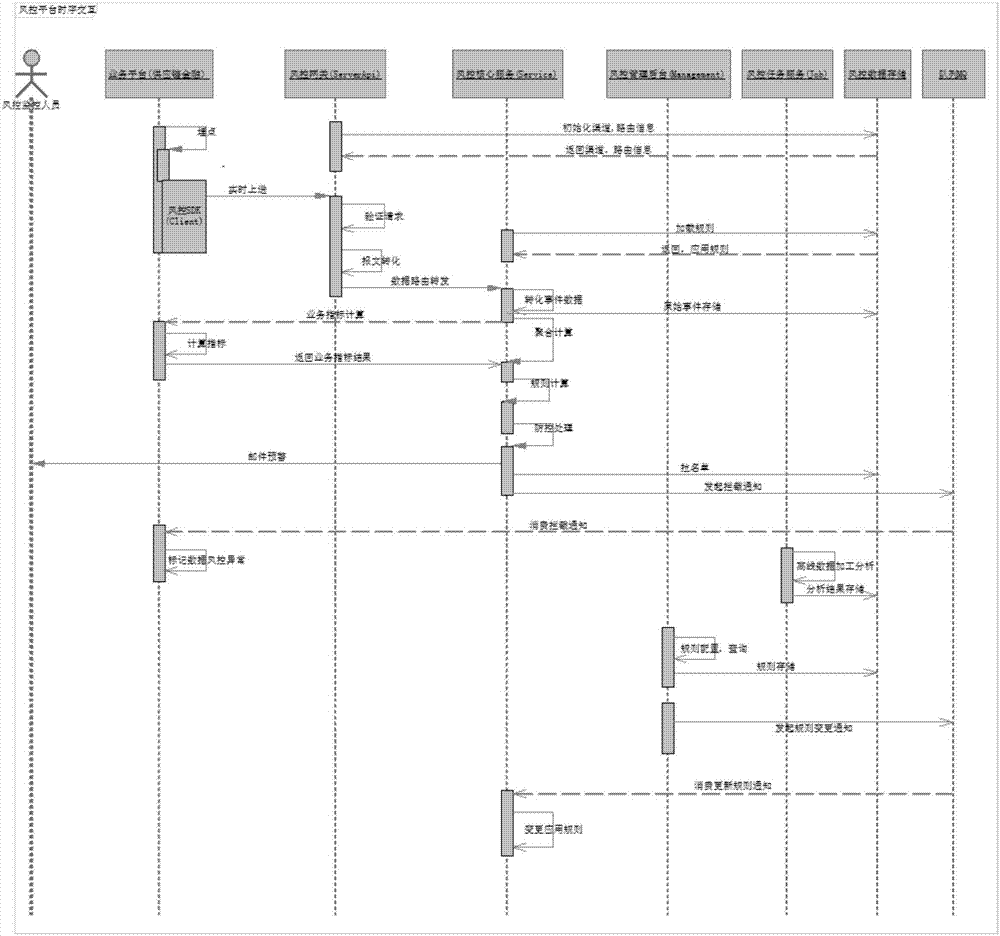

Risk management platform for steel trade financial business and risk management method

ActiveCN107491885APrevent and Avoid RisksLoss prevention and avoidanceResourcesSpecial data processing applicationsReal time analysisBusiness process

A risk management platform a steel trade financial business is a universal integrated risk management service platform which can automatically perform dynamic identification, real-time analysis, risk result processing and evaluation and quantifying the risk according to the data on the risks that are related in a steel trade financial business process based on a risk identification rule. The risk management platform comprises a risk management client frontend unit, a risk management channel gateway unit, a risk management core real-time service unit, a risk management background management service unit, a risk management offline service unit, a risk management near-line service unit and a risk management data service unit. The risk management platform and the risk management method have advantages of realizing abstract universal data model, integrating a rule engine which can be dynamically managed and changed, separating a real-time processing data according to a scene chronergy characteristic, realizing near-line model processing and offline model processing, finishing full-scene coverage of a risk management business, realizing independence between a client and a gateway architecture, reducing impact of business system change to a risk management back-end core, and flexibly decoupling a risk management logic and a business logic.

Owner:SHANGHAI GANGFU E COMMERCE

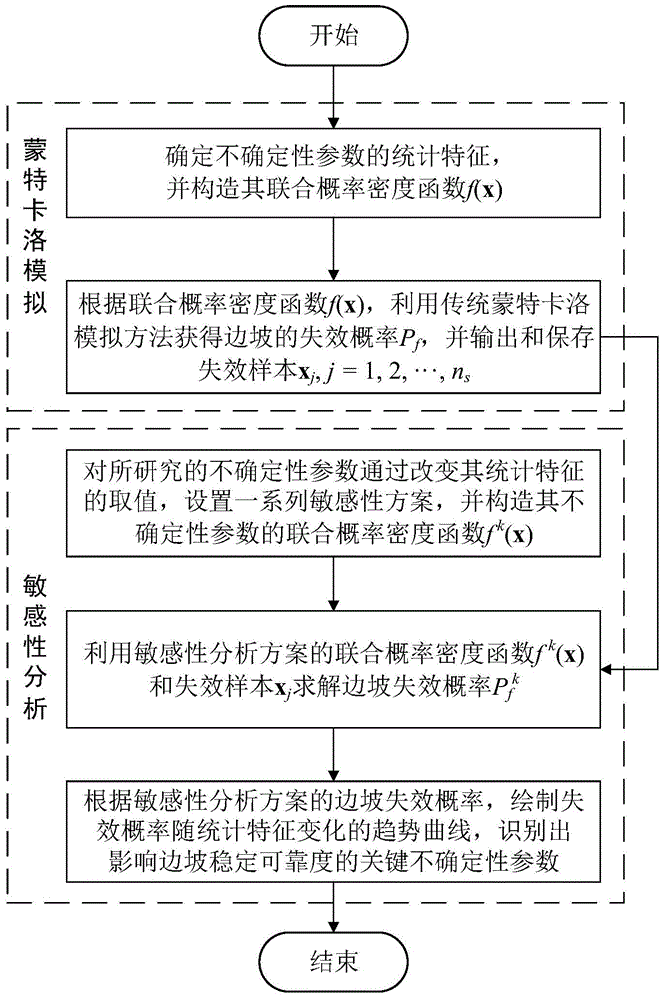

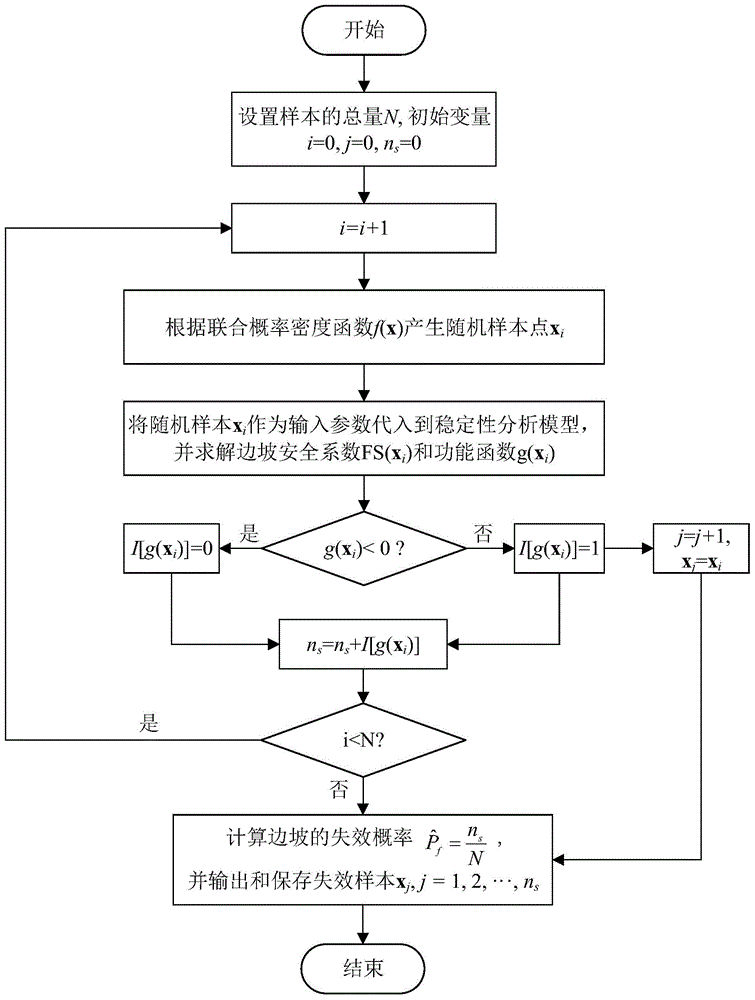

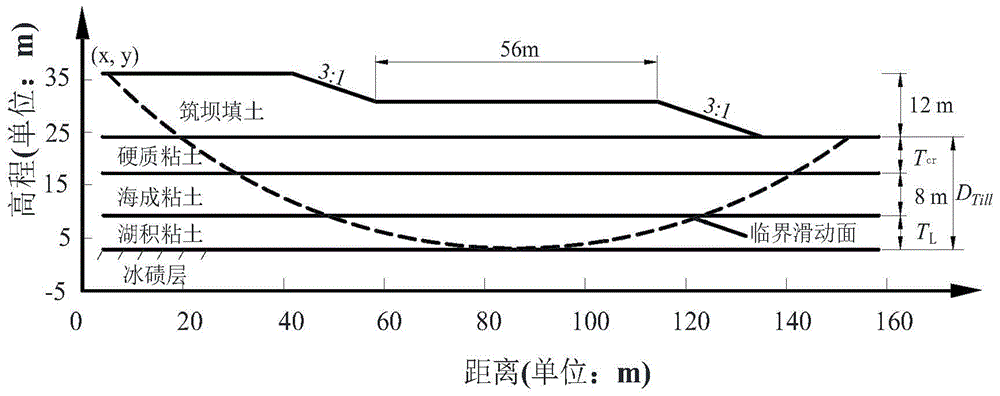

Side slope stable reliability sensitivity analysis method based on Monte Carlo simulation

ActiveCN104899380ASolve the problem of sensitivity analysis of slope stability reliabilityClear conceptSpecial data processing applicationsRisk ControlApplicability domain

The invention provides a side slope stable reliability sensitivity analysis method based on Monte Carlo simulation. The side slope stable reliability sensitivity analysis method based on the Monte Carlo simulation includes: step 1, constructing a joint probability density function of uncertain parameters; step 2, using a Monte Carlo simulation method to obtain a side slope failure probability, and obtaining a failure sample; step 3, designing various sensitivity analysis schemes, and respectively constructing joint probability density functions of uncertain parameters under all the sensitivity analysis schemes; step 4, obtaining side slope failure probabilities under all the sensitivity analysis schemes; step 5, obtaining a variation trend of the side slope failure probabilities along with statistical characteristics of the uncertain parameters according to the side slope failure probabilities under all the sensitivity analysis schemes. The side slope stable reliability sensitivity analysis method based on the Monte Carlo simulation is wide in application range, simple in computation process, high in computation efficiency, and capable of effectively revealing a response regularity between the reliability level of a side slope and the statistical characteristics of the uncertain parameters, and has certain guiding significance for side slope risk control, design optimization and the like.

Owner:WUHAN UNIV

Credit investigation data sharing and trading system

InactiveCN106780007APerfect risk control levelSolve imperfectionsFinanceBuying/selling/leasing transactionsRisk ControlData provider

The invention relates to a credit investigation data sharing and trading system. The credit investigation data sharing and trading system comprises at least two P2P network nodes; each of the P2P network nodes comprises a bottom block chain system and a credit data sharing platform which is operated on the bottom block chain system; and each credit data sharing platform comprises a data sharing module, a data querying and trading module and a block chain adaption layer. According to the credit investigation data sharing and trading system, a block chain technology is utilized to construct a credible credit data sharing and trading platform; and by using a special data sharing mechanism, a data query mechanism and a data trading mechanism, credit data owners and credit data demanders can be attracted, so that credit data providers can realize data trading under the condition that the data is protected, and credit data query parties can obtain the credit data to improve the own risk control levels.

Owner:树读(上海)信息科技有限公司

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com