Patents

Literature

122 results about "Risk exposure" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

Risk exposure. The quantified potential for loss that might occur as a result of some activity. An analysis of the risk exposure for a business often ranks risks according to their probability of occurring multiplied by the potential loss, and it might look at such things as liability issues, property loss or damage, and product demand shifts.

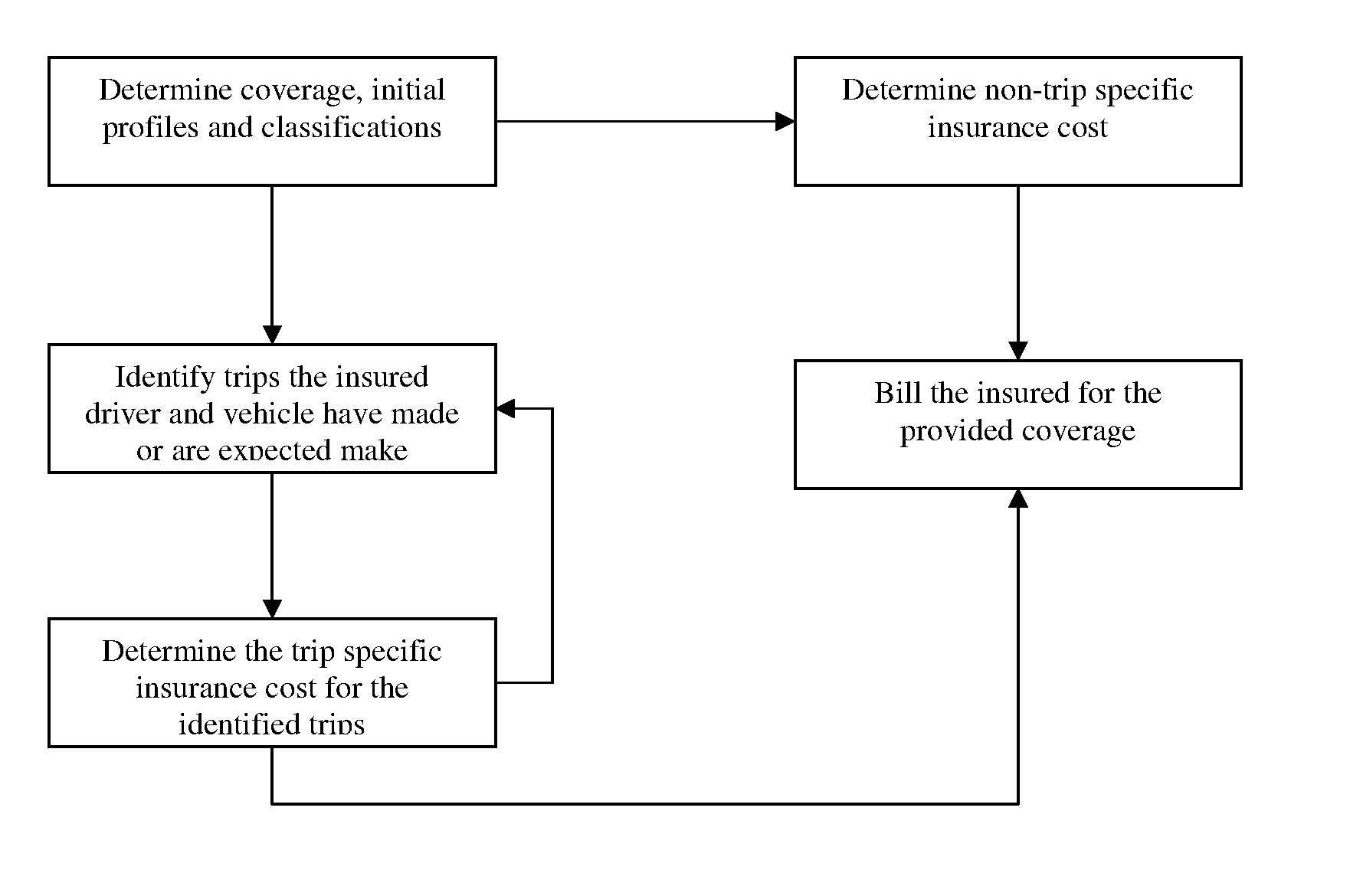

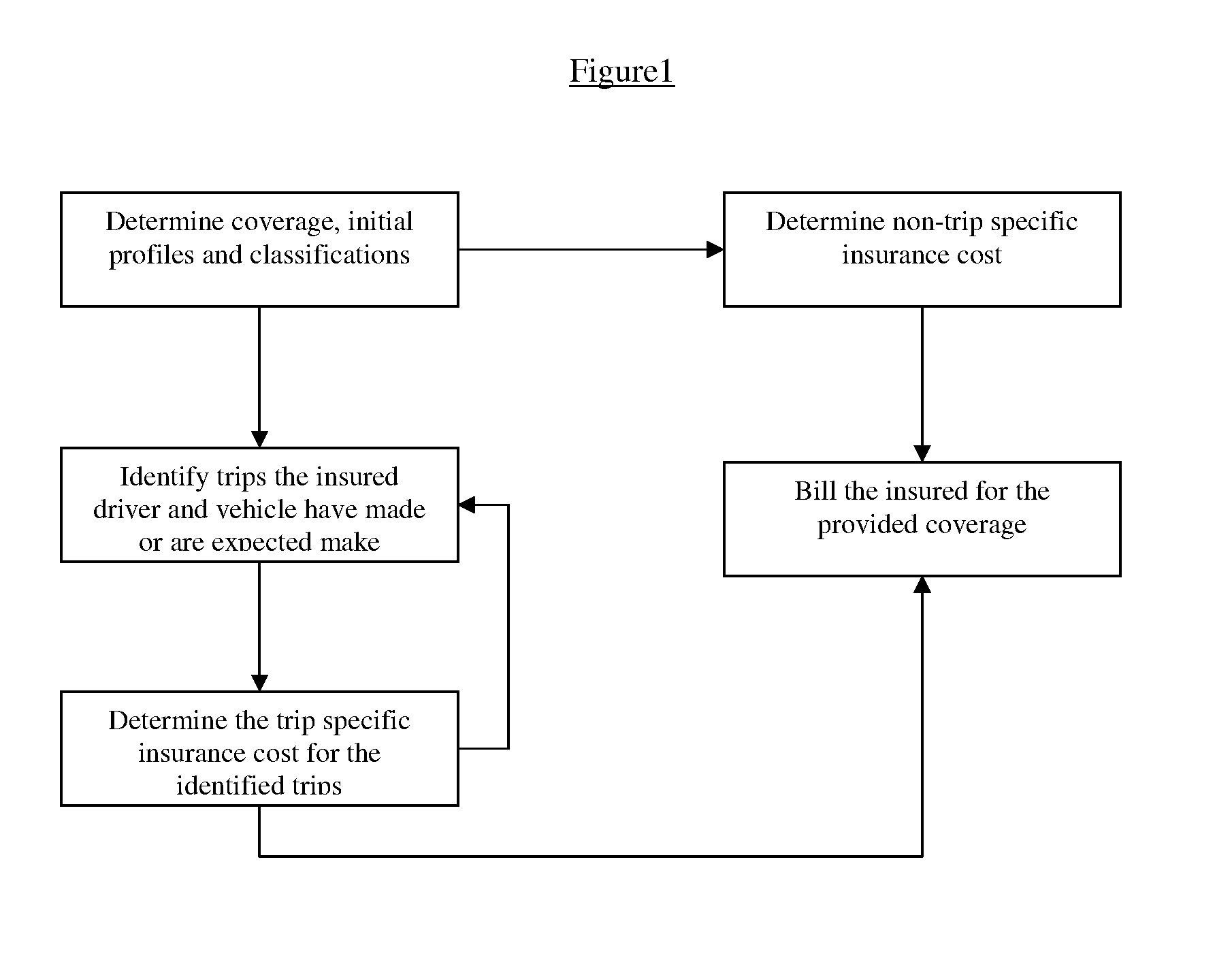

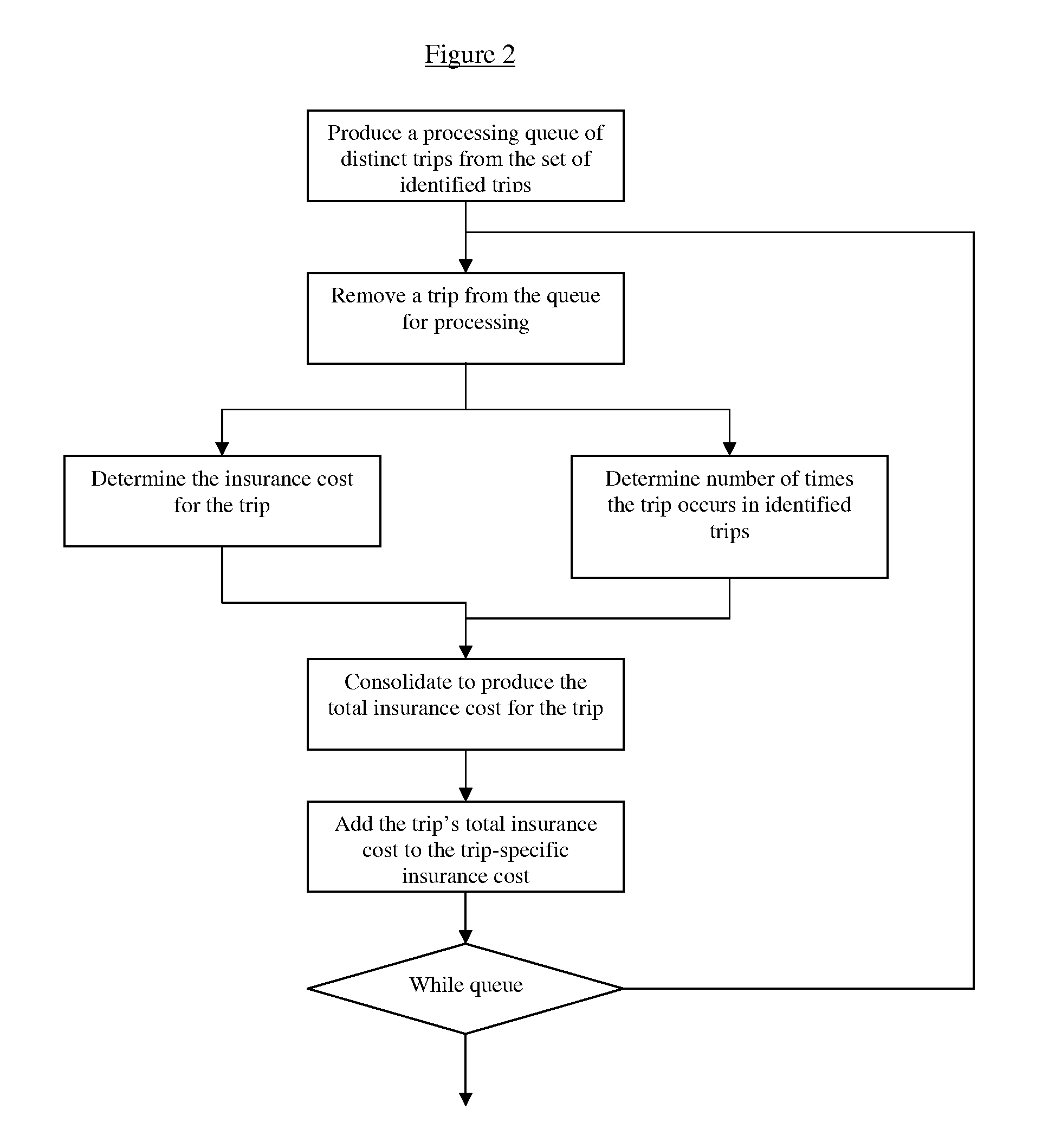

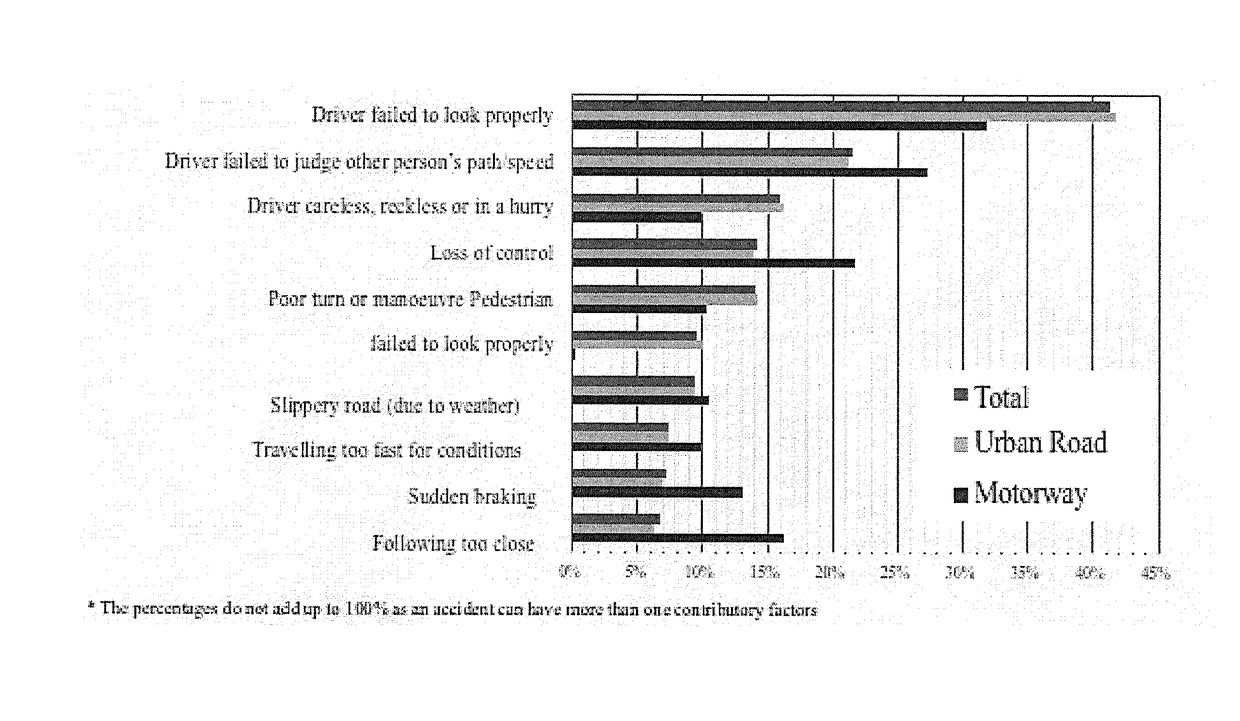

Route based method for determining cost of automobile insurance

A method and system of determining cost of automobile insurance based on safety characteristics of road segments comprising routes expected to be followed on trips insured vehicle and driver have made or are expected to make over the time period the insurance contract is in force. The method comprises steps of identifying the trips, selecting routes expected to be followed on the said trips, determining the probability of each selected route being followed on a trip, evaluating the safety characteristics of roads comprising the routes, consolidating the route safety information with the assigned route probabilities and other risk classifications to produce cost of insurance for the identified trips. The results are further consolidated with the cost of insurance due to risk exposures other than those of the identified trips to produce a final insurance cost.

Owner:SUROVY MARTIN

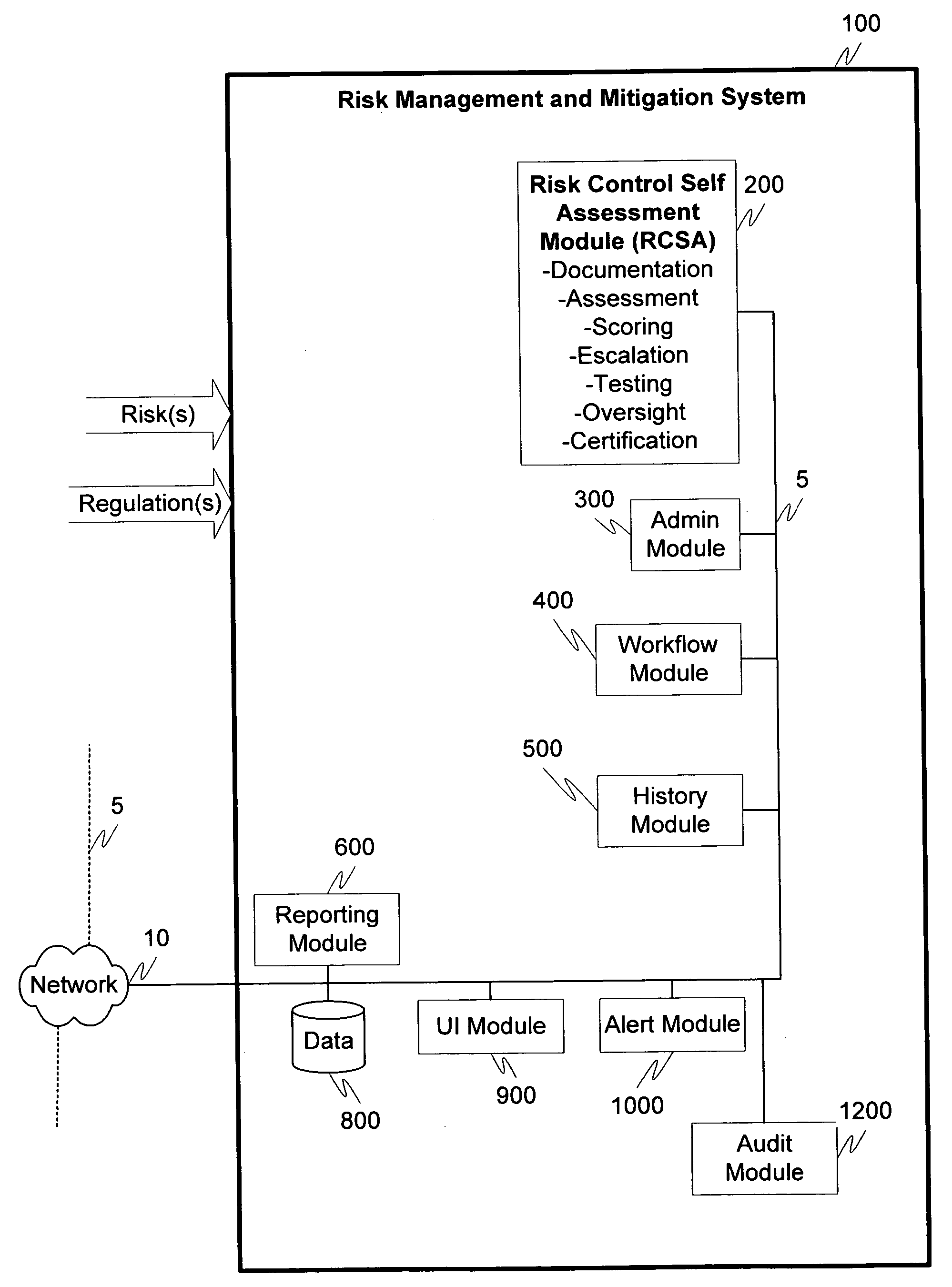

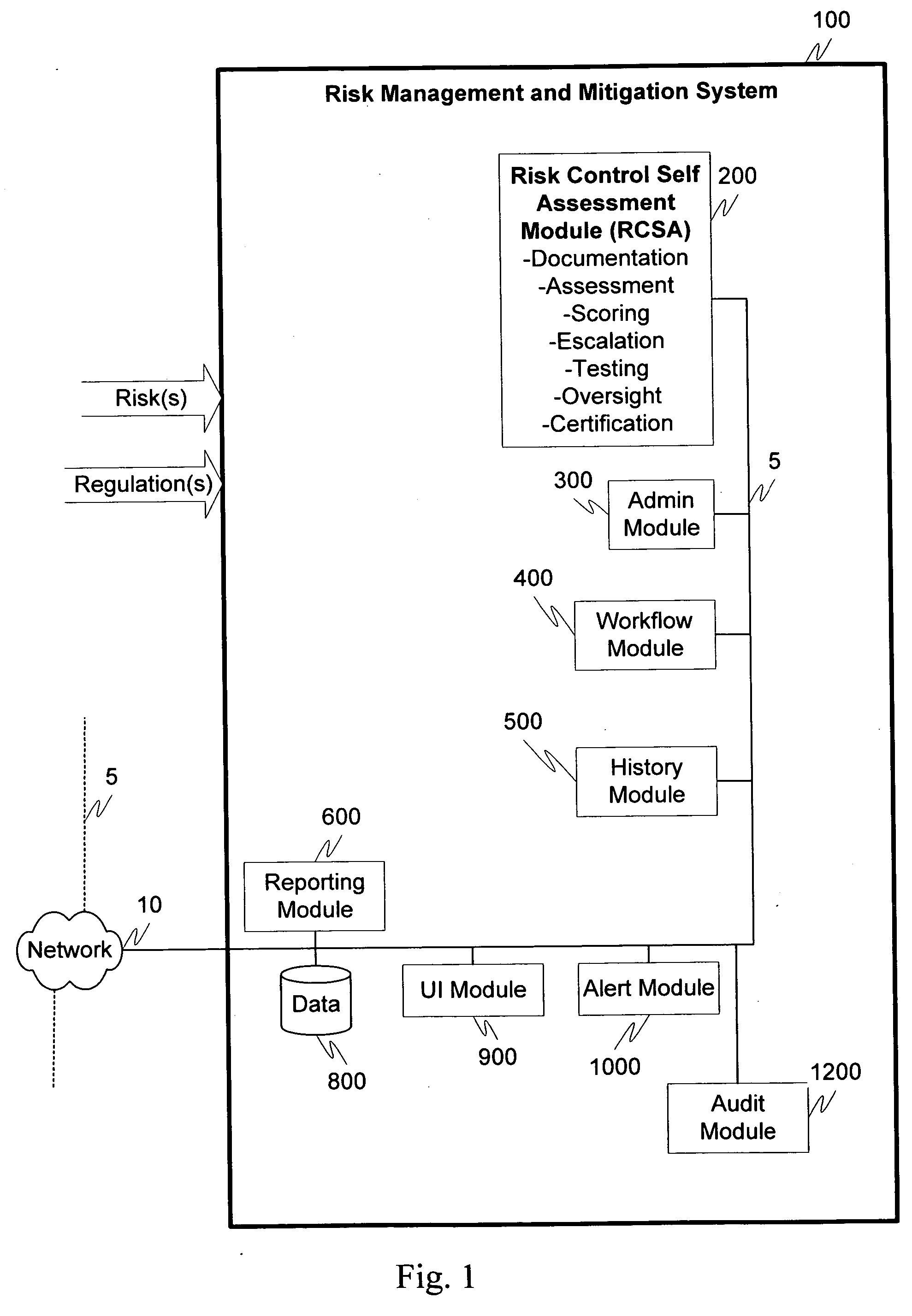

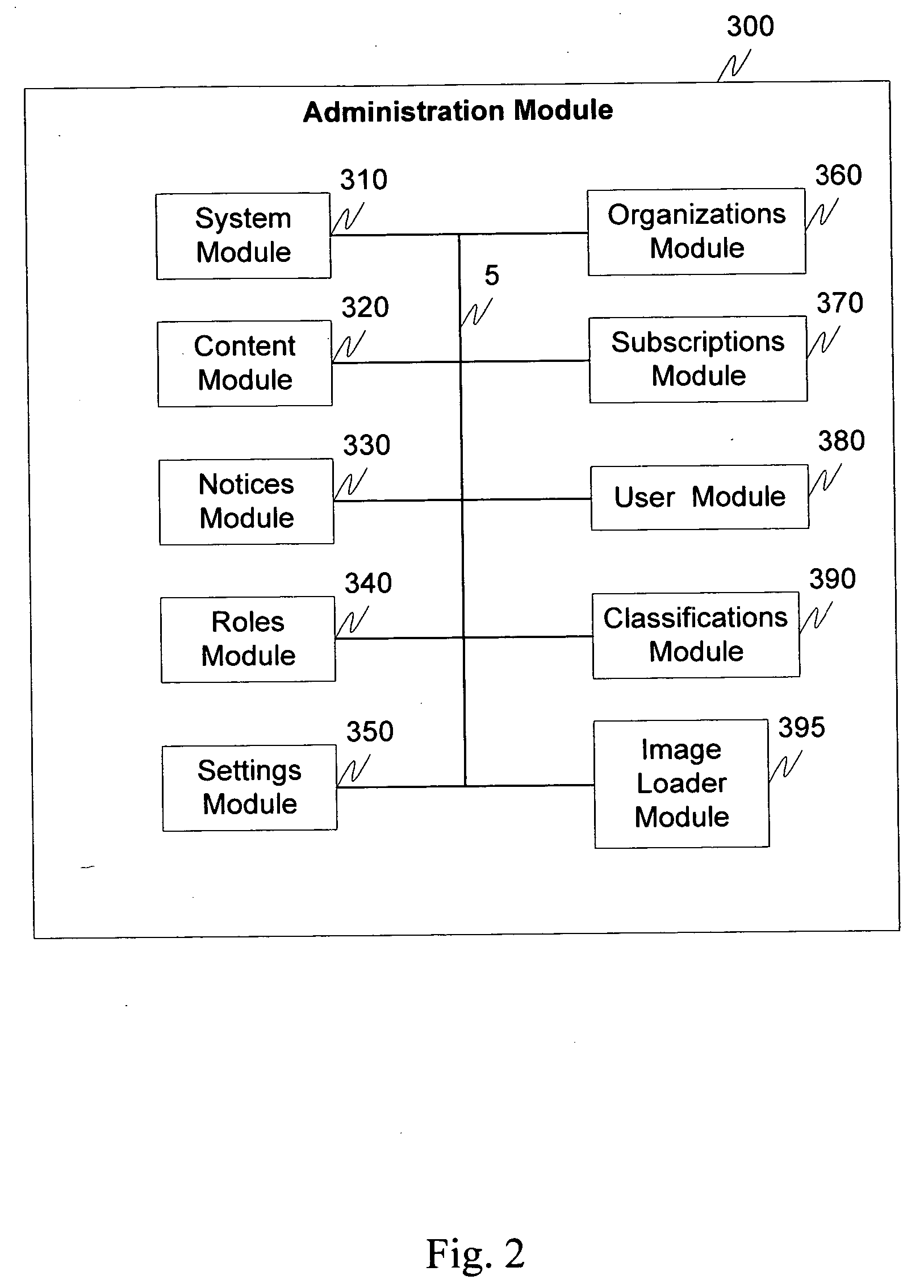

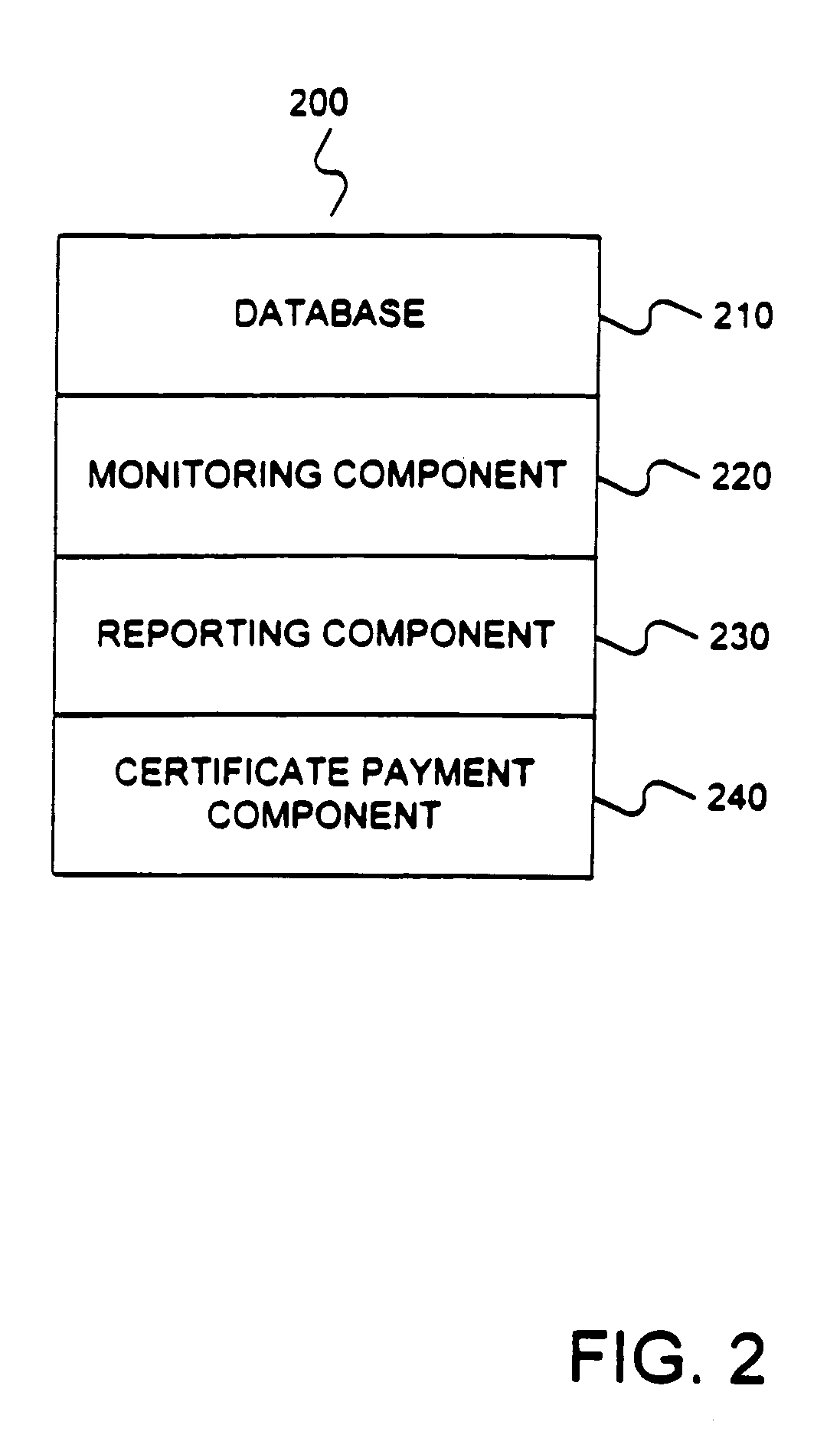

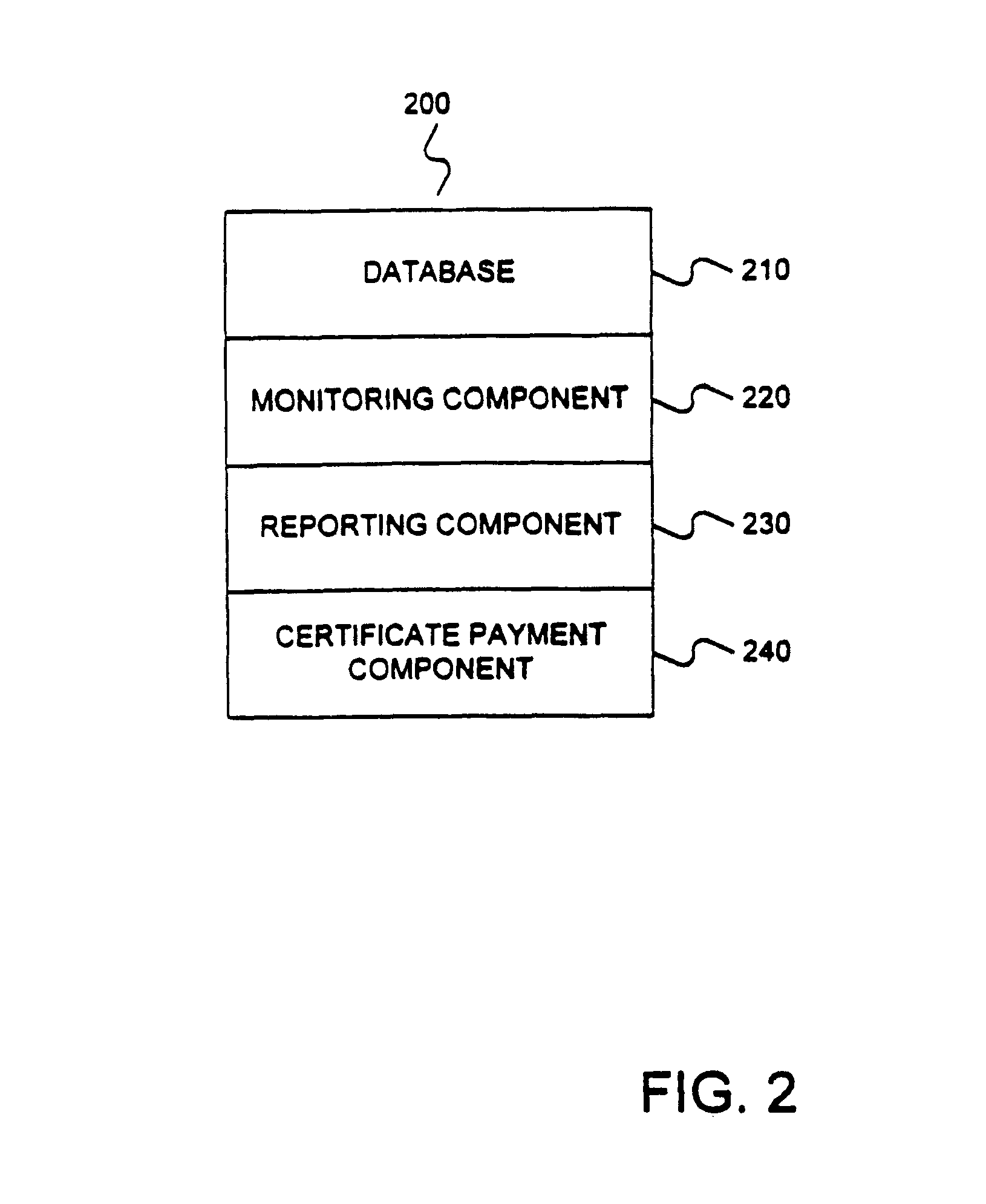

Risk mitigation management

InactiveUS20050197952A1Quicker and easy role-up certification reportReduce lossesFinanceSpecial data processing applicationsRisk exposureVisibility

Risk mitigation and management is provided through an executive management application for the active management of operational risks, derived from exposure to factors that threaten strategic objectives related to operations, strategy, regulation and recording priorities. This system is based on a architecture that automates the Committee Of Sponsoring Organizations (COSO) framework for enterprise risk management, using the objective, risk, control and actions (ORCA) methodology to actively manage risk at the business unit level. This business process and feedback mechanism actively isolates, evaluates and escalates risks and controls in an interactive, proactive and dynamic manor. Workflow, alerts, messaging and roles and permission profiles route risk information to all relevant entities to ensure enterprise-wide visibility of, for example, a companies overall risk exposure.

Owner:PROVIDUS SOFTWARE SOLUTIONS

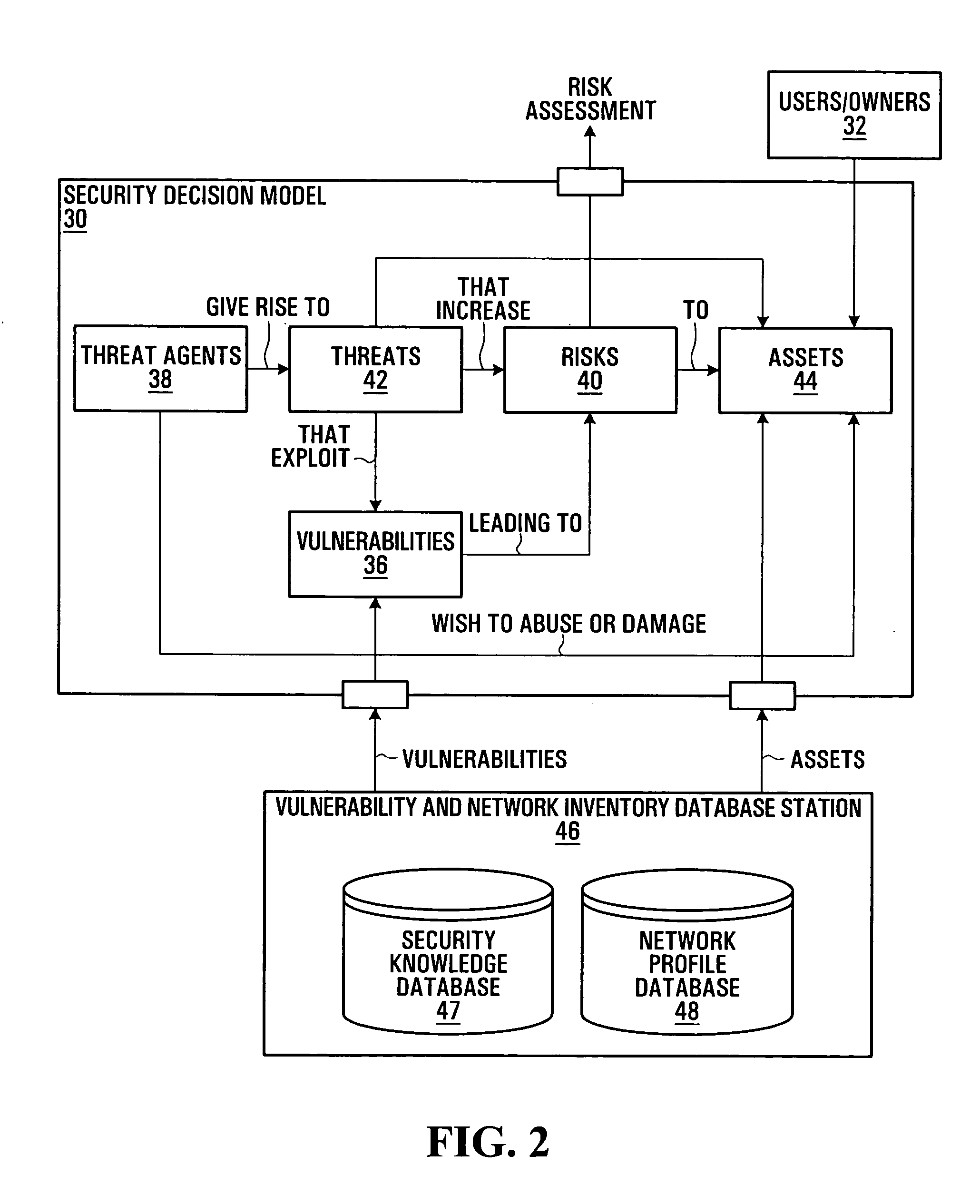

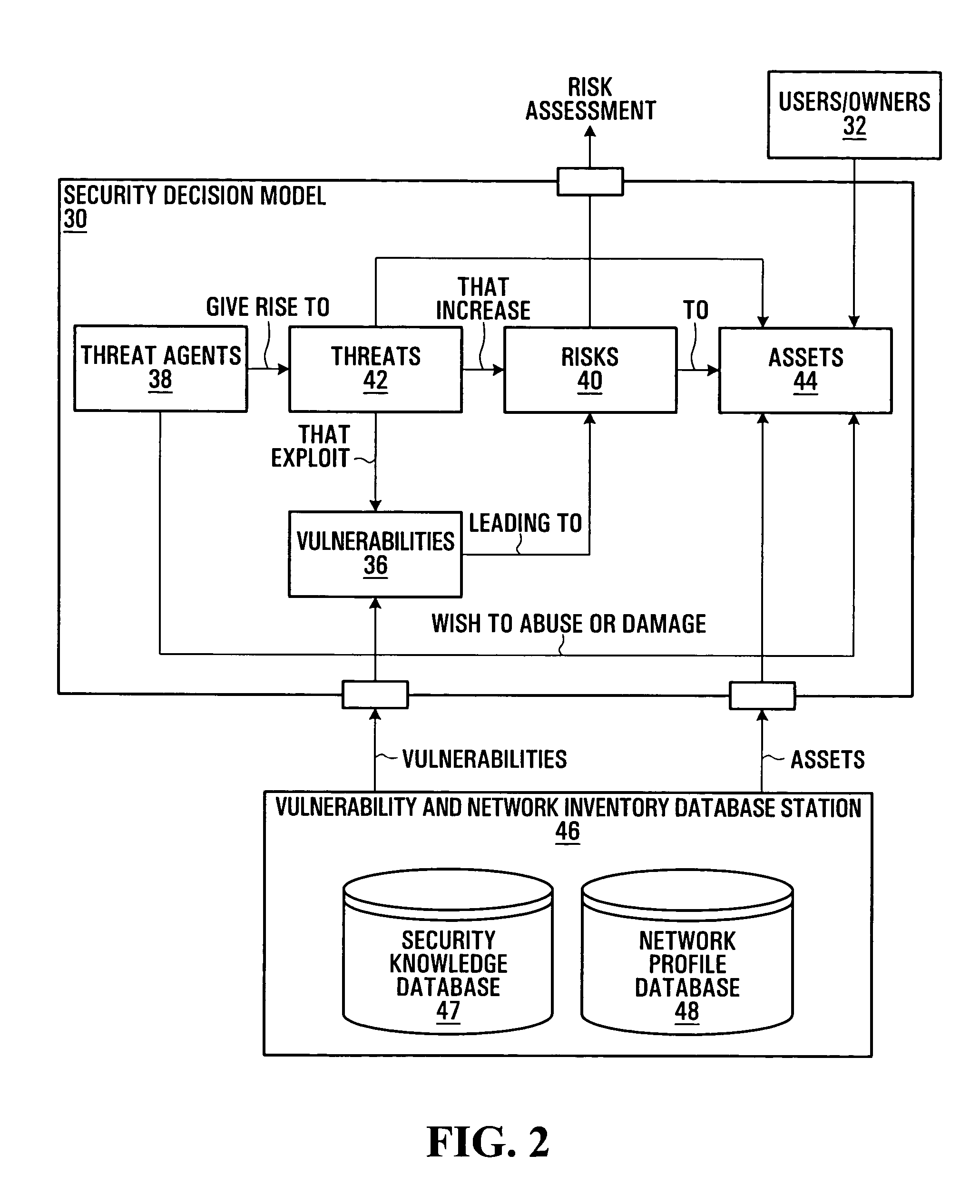

Communication network security risk exposure management systems and methods

Communication network security risk exposure management systems and methods are disclosed. Risks to a communication network are determined by analyzing assets of the communication network and vulnerabilities affecting the assets. Assets may include physical assets such as equipment or logical assets such as software or data. Risk analysis may be adapted to assess risks to a particular feature of a communication network by analyzing assets of the communication network which are associated with that feature and one or more of vulnerabilities which affect the feature and vulnerabilities which affect the assets associated with the feature. A feature may be an asset itself or a function or service offered in the network and supported by particular assets, for example.

Owner:HUAWEI TECH CO LTD

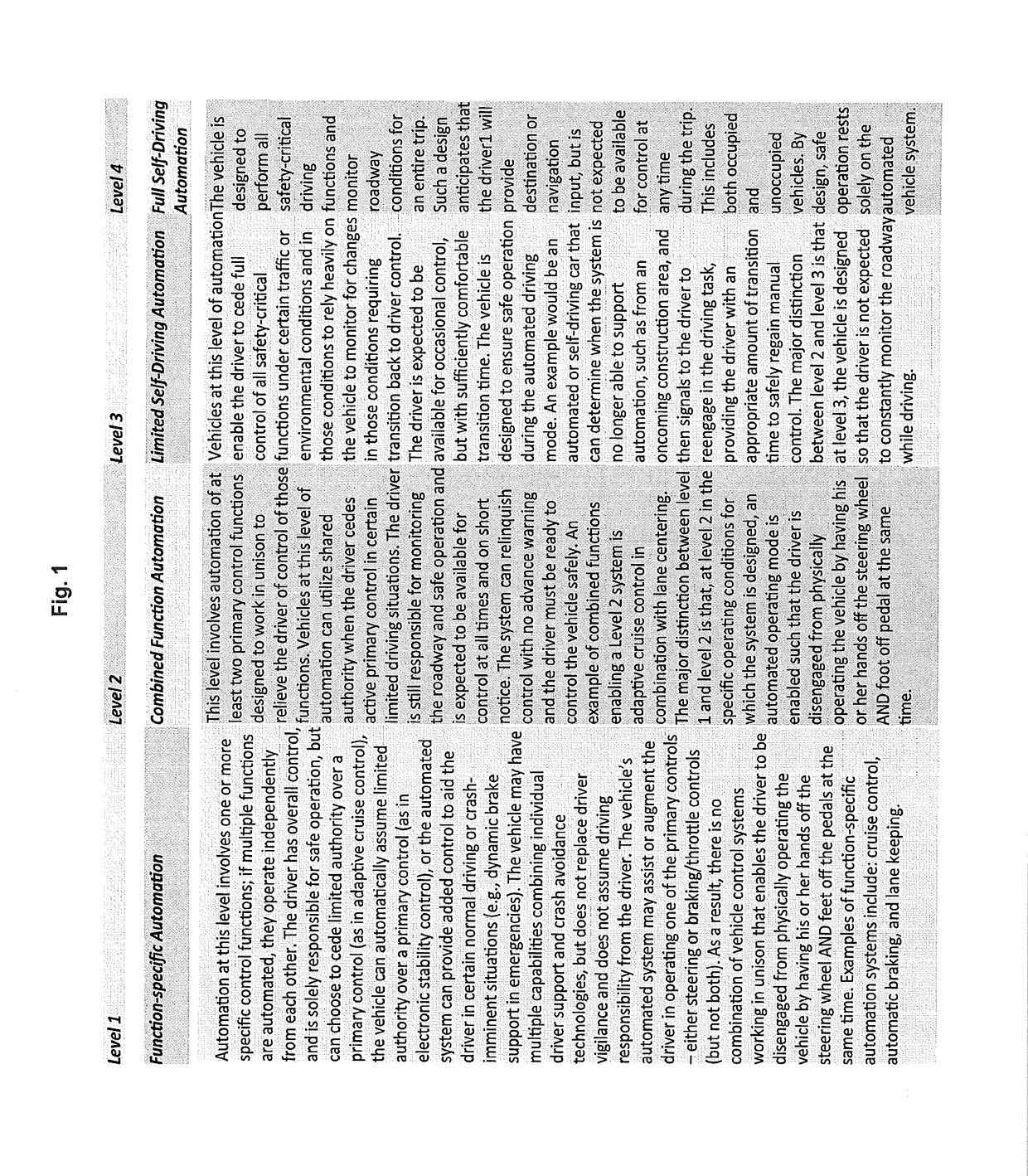

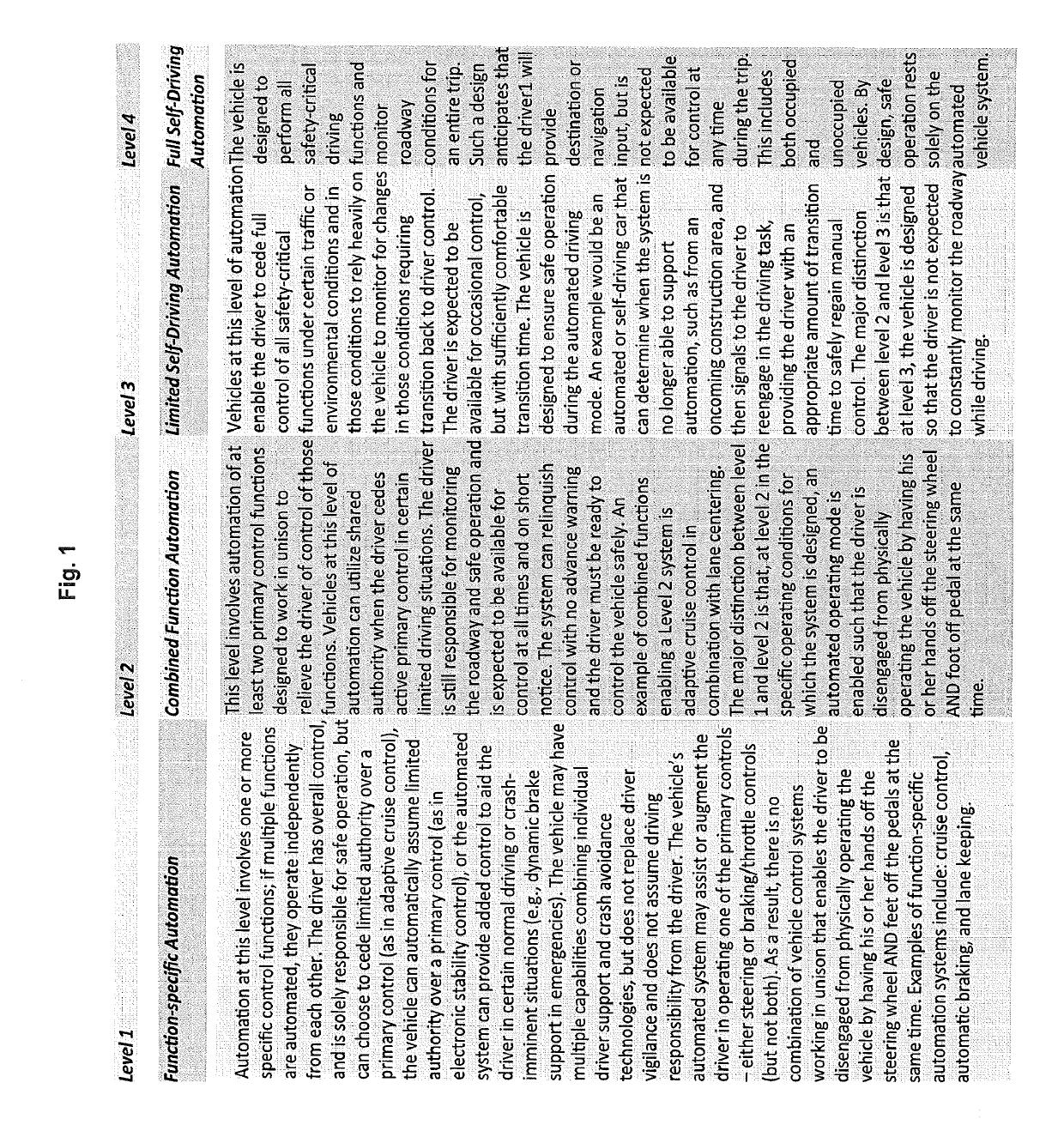

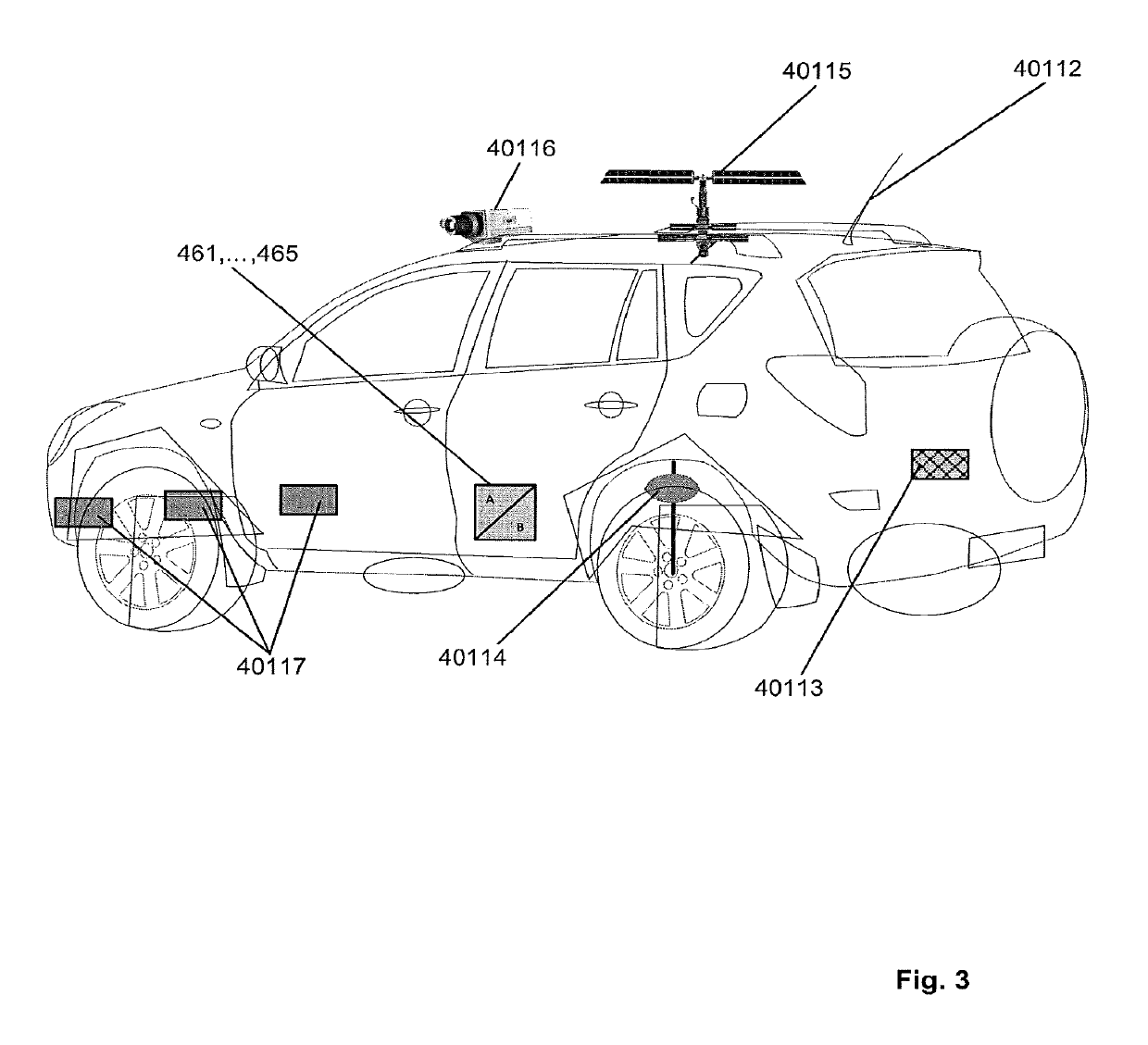

Autonomous or partially autonomous motor vehicles with automated risk-controlled systems and corresponding method thereof

ActiveUS20170372431A1Improve system stabilityImprove stabilityFinanceRegistering/indicating working of vehiclesPaymentRisk exposure

Aspects of the disclosure include a first risk-transfer system, a second risk-transfer system, and an expert-system based circuit. The first risk-transfer system is configured to provide a first risk-transfer based on first risk-transfer parameters from a plurality of motor vehicles to the first risk-transfer system, and receive and store first payment parameters associated with risk exposures of the plurality of motor vehicles. The second risk-transfer system is configured to provide a second risk-transfer based on second risk-transfer parameters from the first risk-transfer system to the second risk-transfer system, and receive and store second payment parameters associated with risk exposures transferred to the first risk-transfer systems. The expert-system based circuit is configured to receive environmental parameters and operating parameters from the plurality of motor vehicles, adjust the first risk transfer parameters and correlated first payment transfer parameters, and adjust the second risk transfer parameters and correlated second payment transfer parameters.

Owner:SWISS REINSURANCE CO LTD

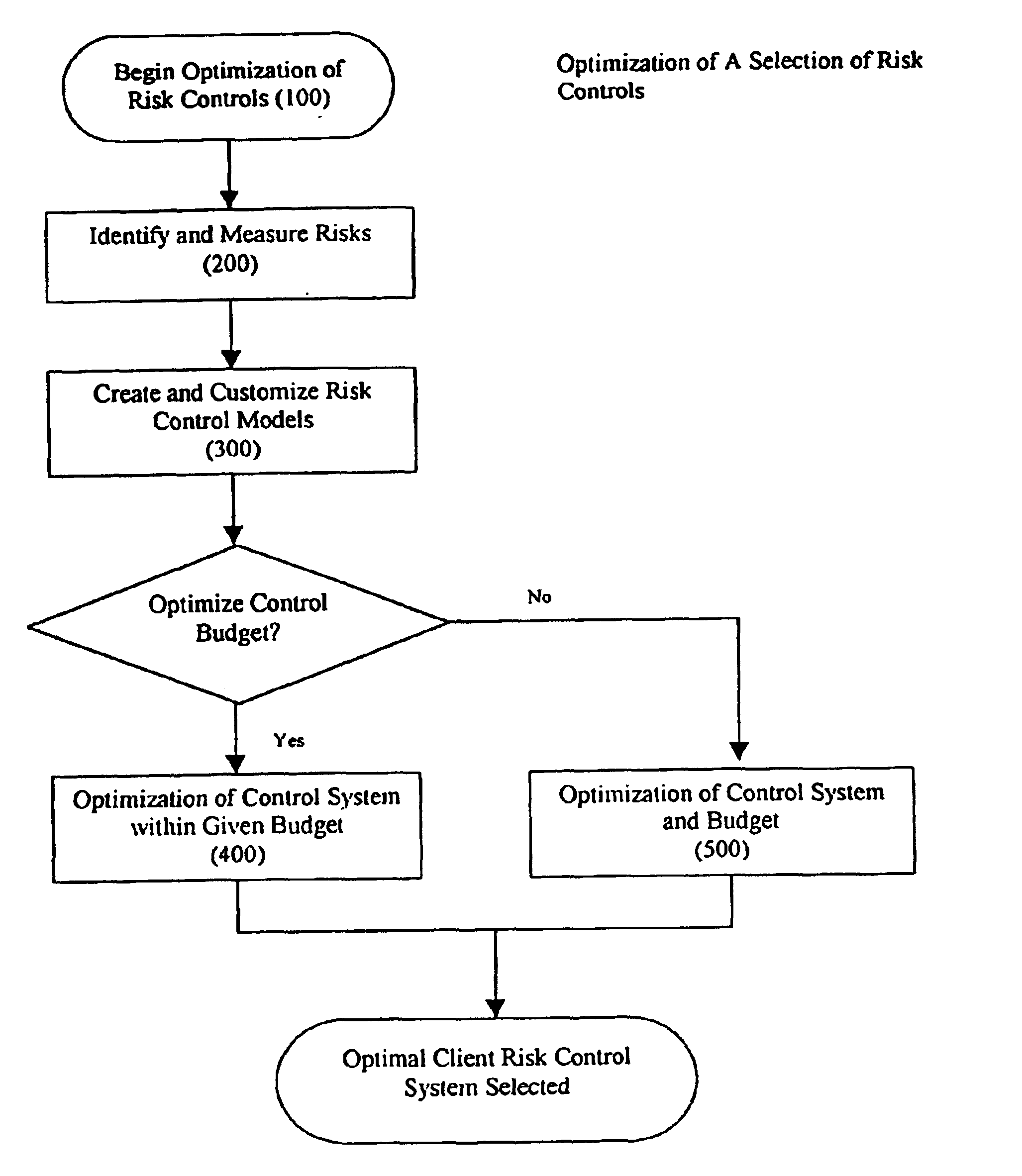

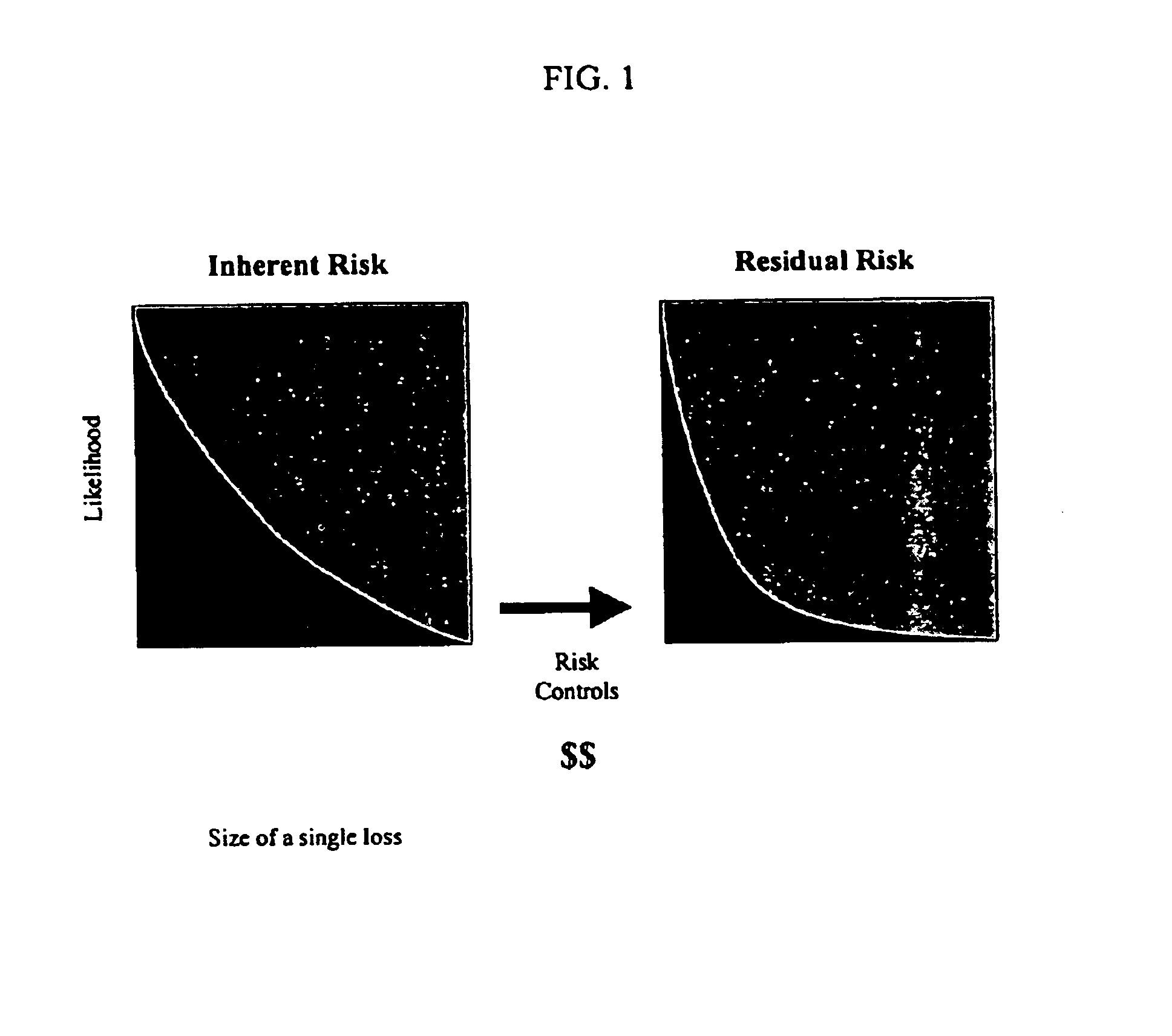

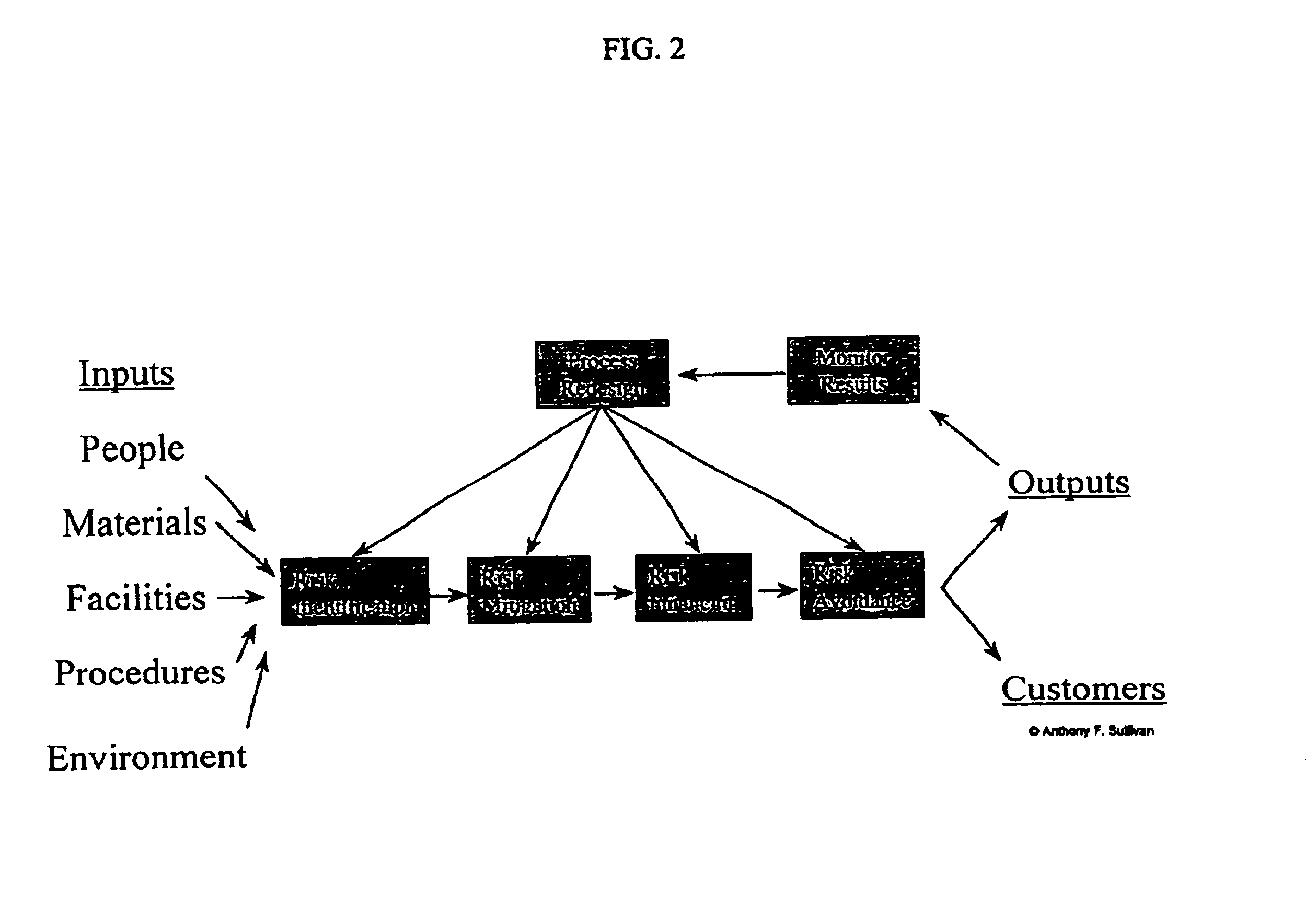

Method and system for risk control optimization

InactiveUS6876992B1Economic value maximizationHigh economic valueFinanceComputation using non-denominational number representationRisk exposureRisk Control

A method and system for selecting an optimal set of management and risk controls for a given set of risks within a variable control budget. Specifically, optimization according to the present invention is defined using a method and system to calculate the greatest reduction in an organization's risk exposure with the minimum investment in cost and time as measured by the economic value added of the risk system change. Risk control models and management risk control models are client customized into a risk control system specifically addressing a clients applicable risks and their associated exposures. An operator is able to determine which risk control system maximizes available resources while also reducing an organization's total risk exposure.

Owner:WILLIS NORTH AMERICA

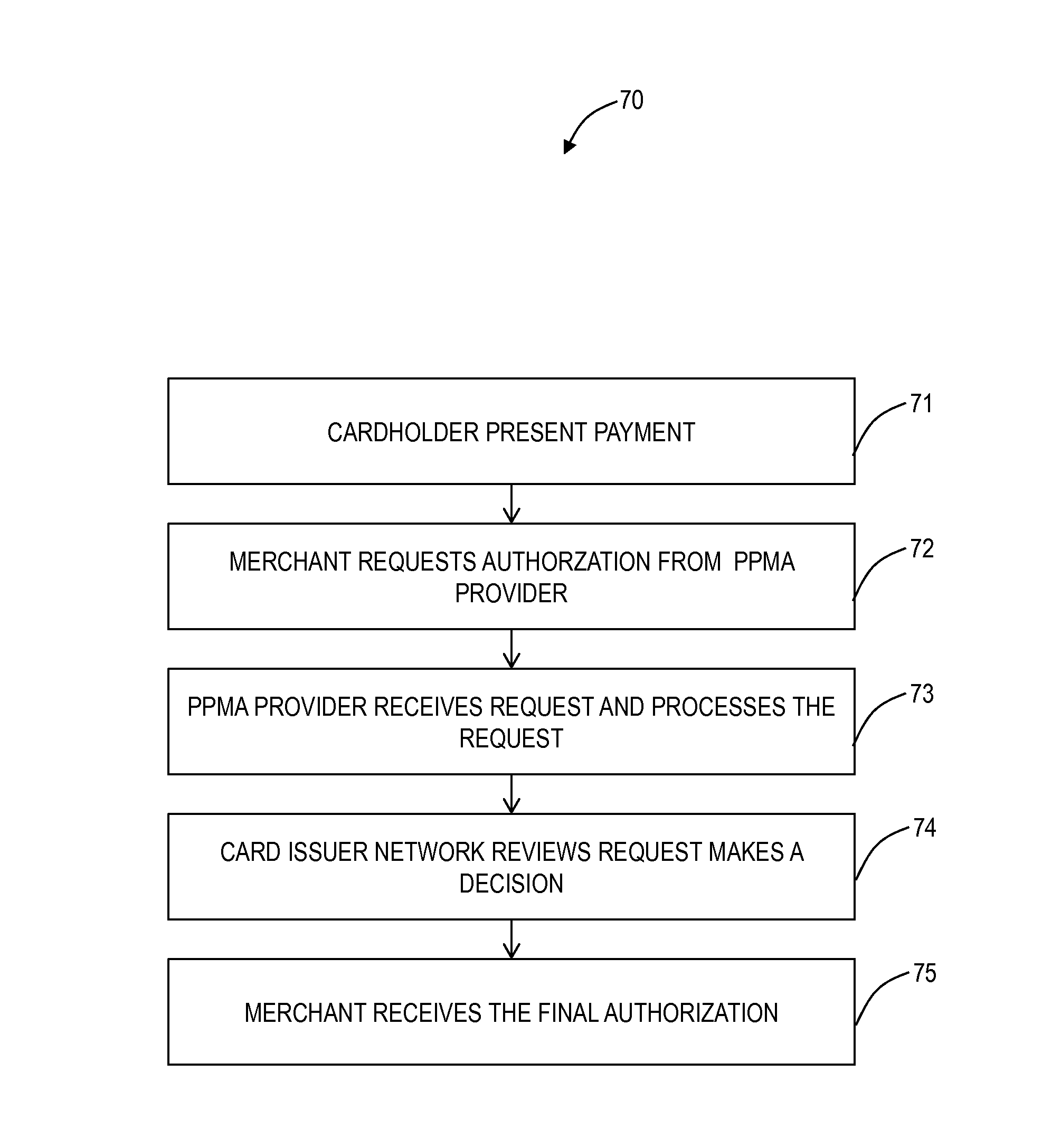

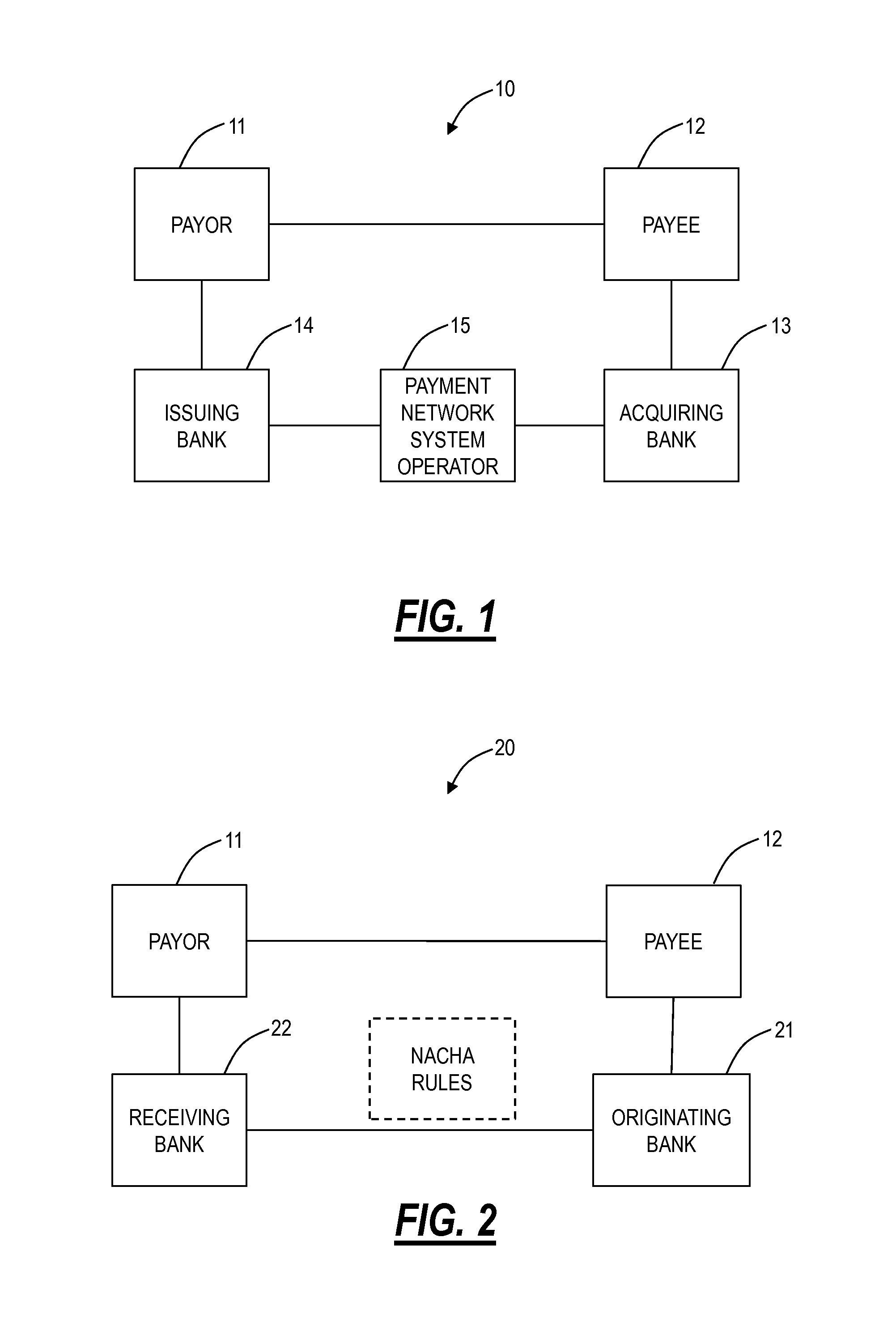

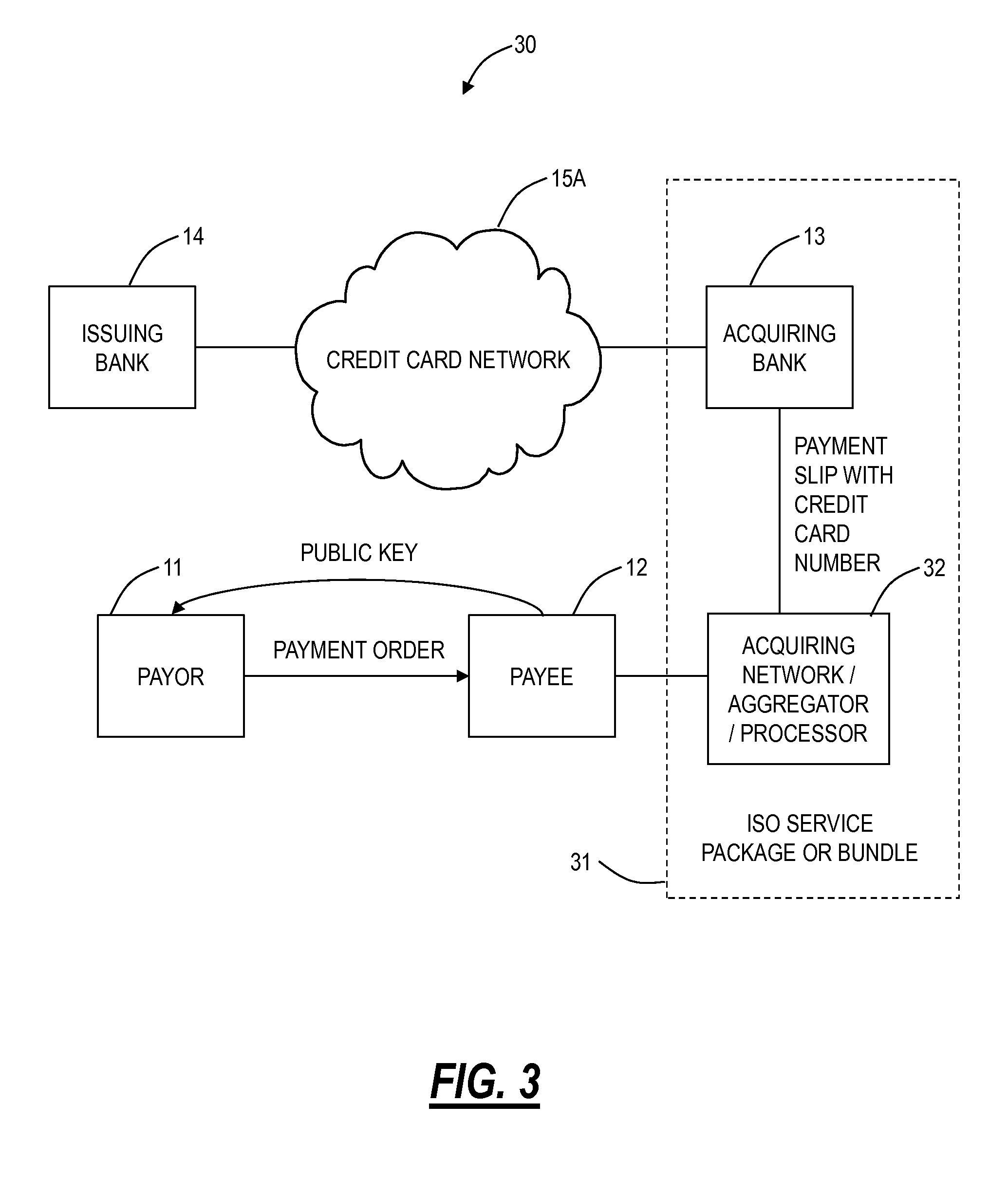

Systems and methods for prepaid merchant payment services

A computer implemented method, a system, and software provides a new processing origination model allowing a new 6th party in payment processing systems and networks, to inspect transactions before they are authorized, enabled or further processed by the payment or settlement network. This new processing delivery system and method may limit or reduce the service operators risk exposure to a defined limit, thereby improving the service providers' ability to manage a known and quantifiable risk level per merchant while limiting the system implementer's total amount of risk and improving both the speed of underwriting and merchant approval process.

Owner:GLOBAL STANDARD FINANCIAL

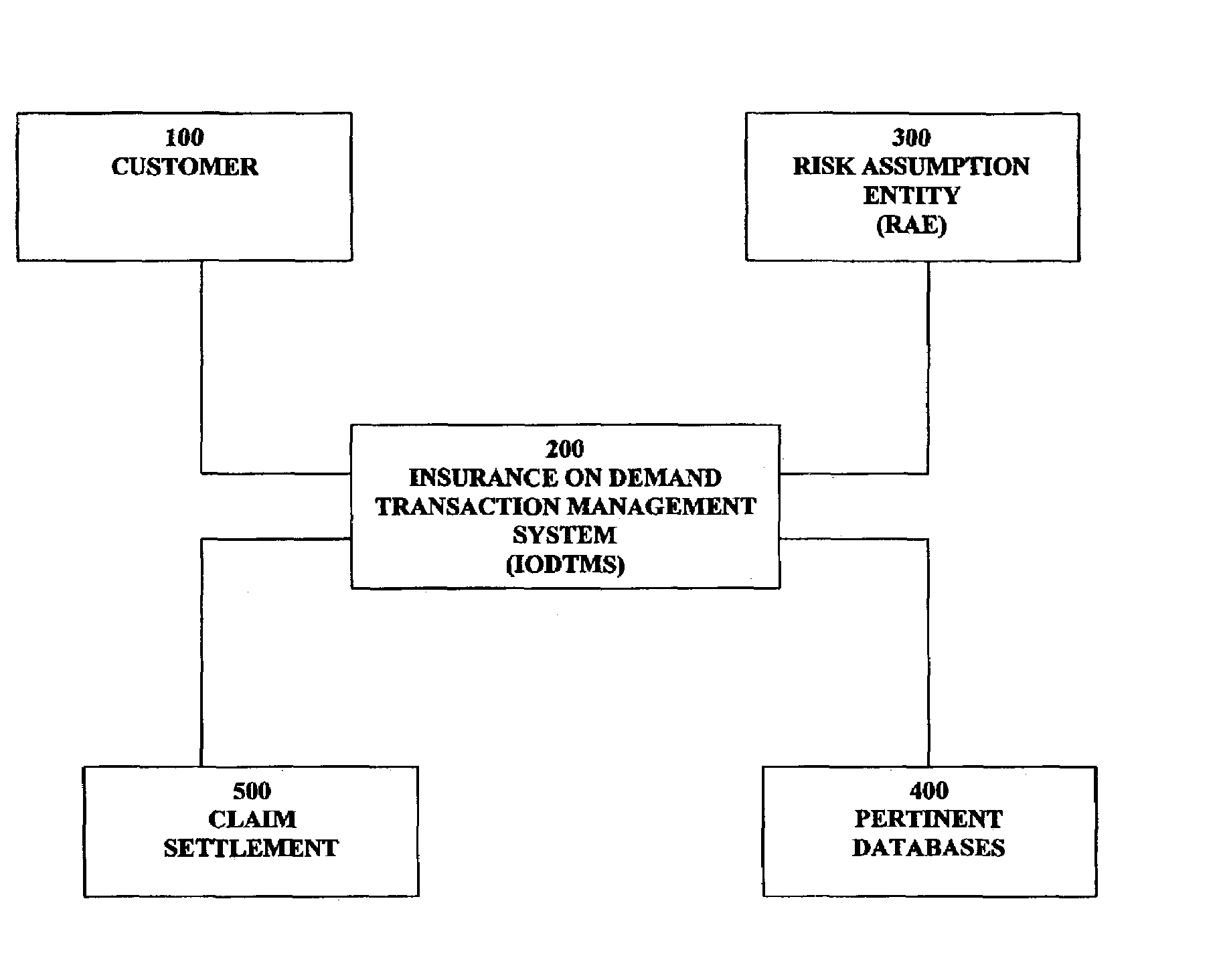

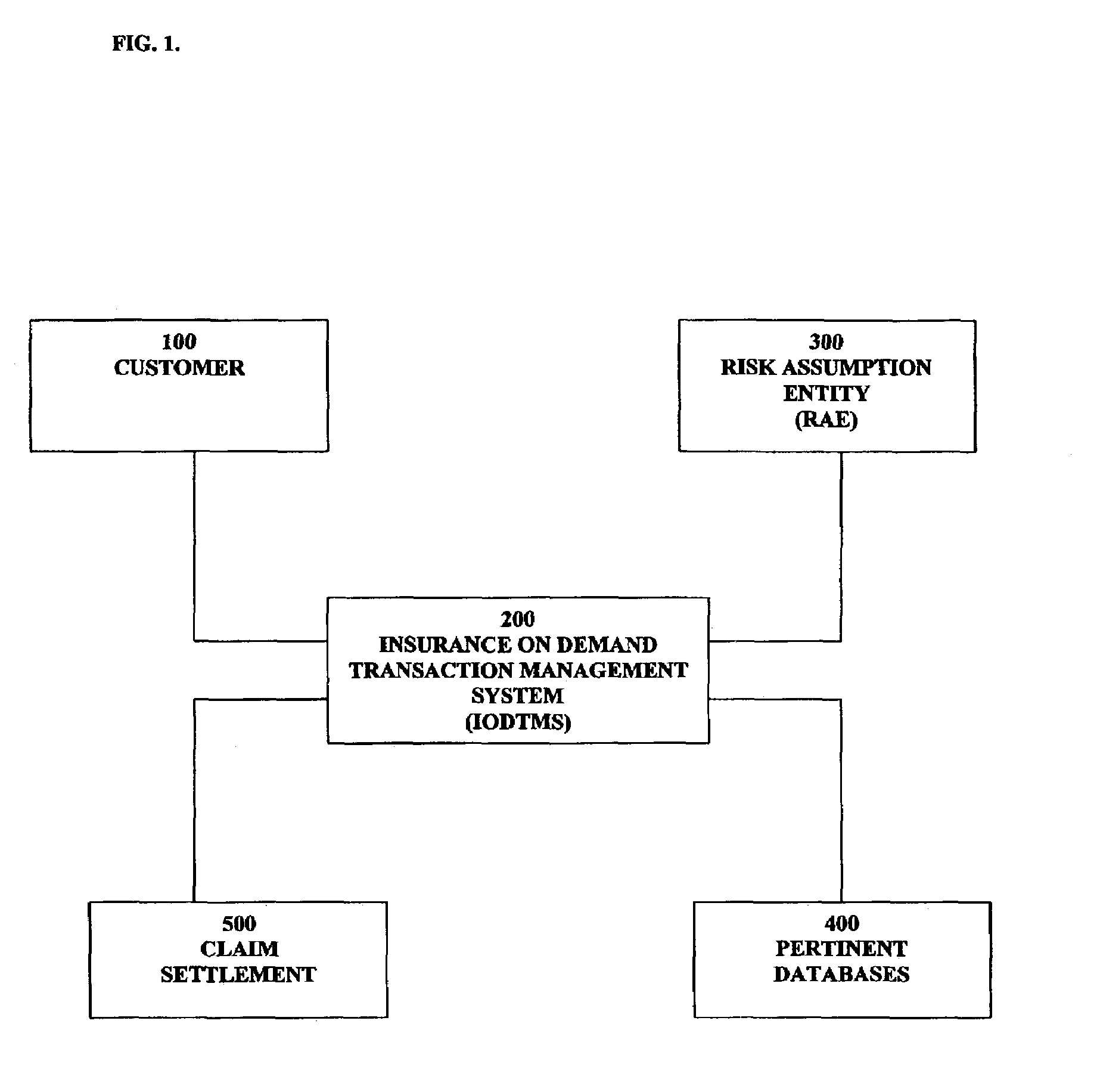

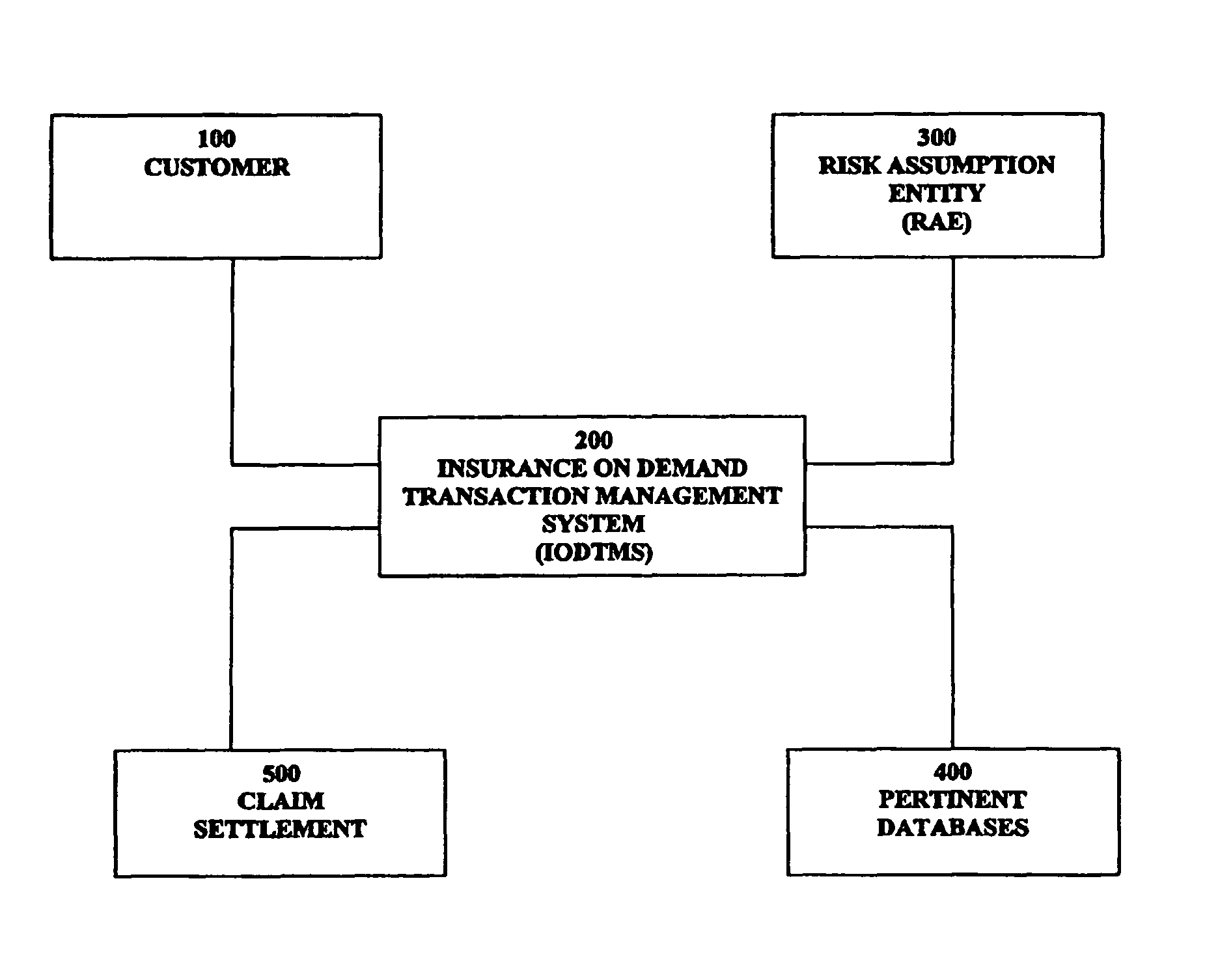

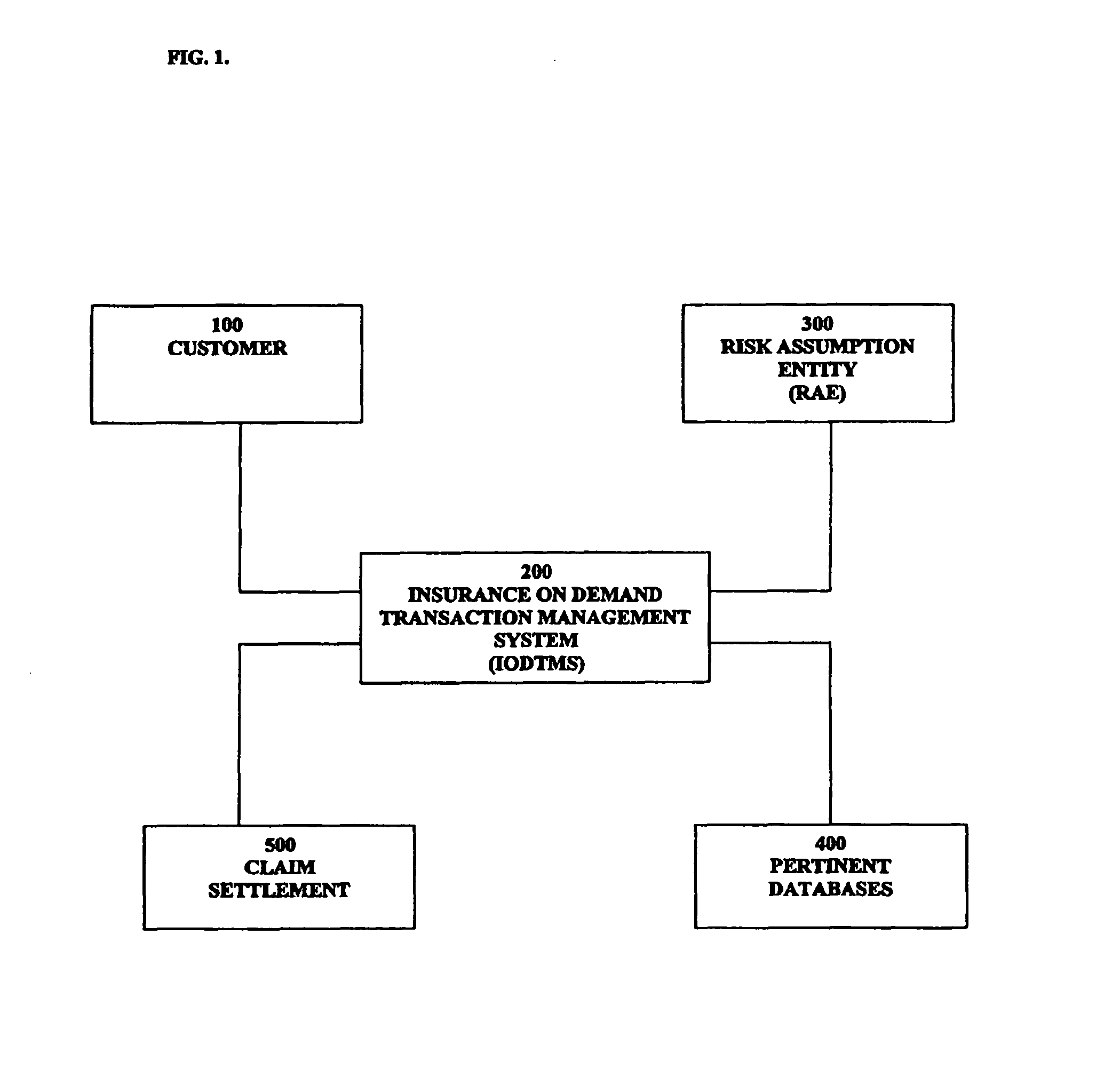

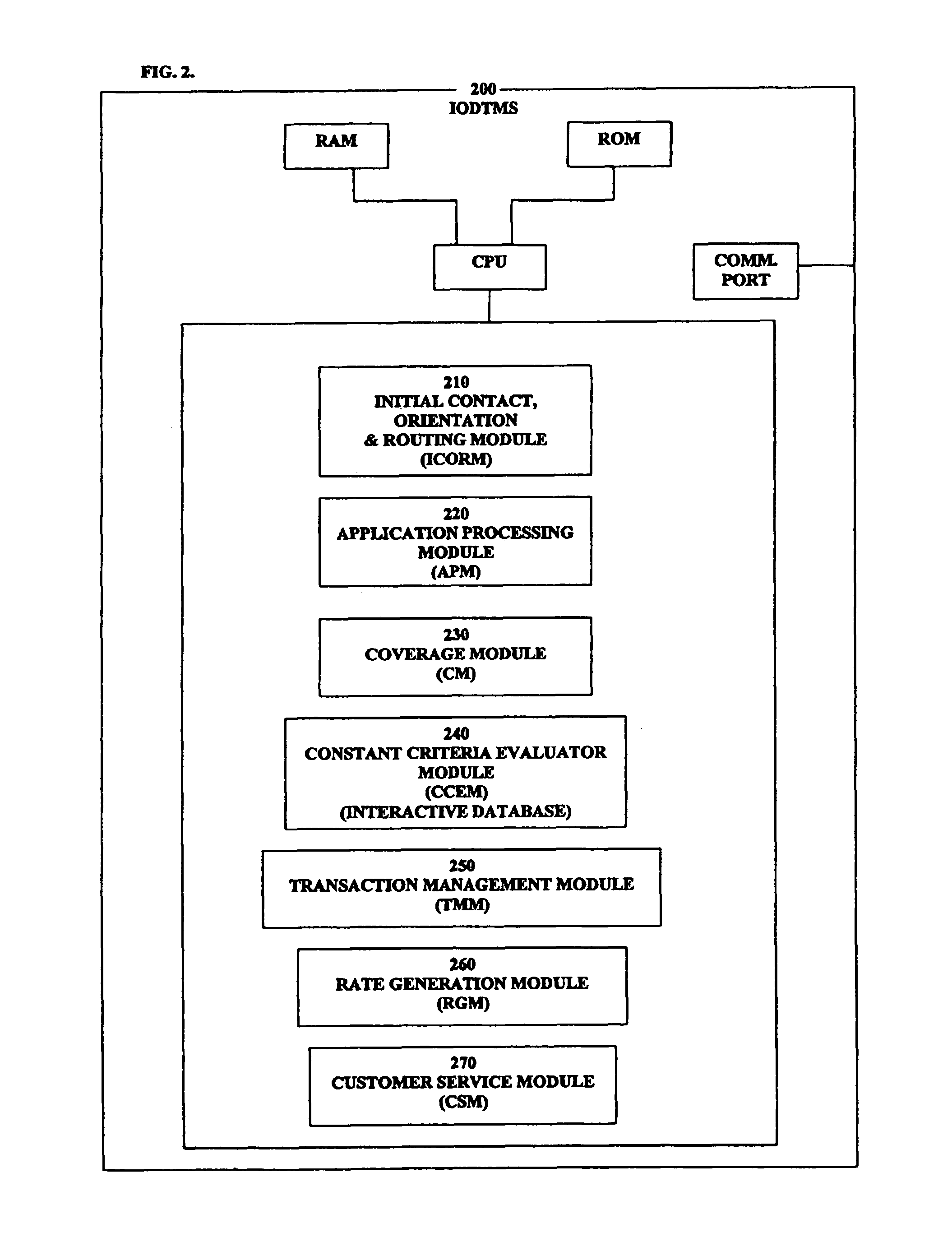

Insurance on demand transaction management system

An intermittent risk exposure liability insurance method comprising the steps of: establishing an Internet business site enabled for communication with insurers and insureds through Internet service providers; enrolling the insureds in intermittent risk exposure liability insurance policies, the policies providing for a variable insurance premium rate depending upon an intermittent use of an insured article; logging start and completion times of each intermittent use of the insured article on the Internet business site by the insured; verifying start and completion times of use of the insured article in accordance with the logged start and completion times; and applying and billing premium insurance rates in accordance with the verified and logged start and completion times of use.

Owner:STRECH KENNETH RAY

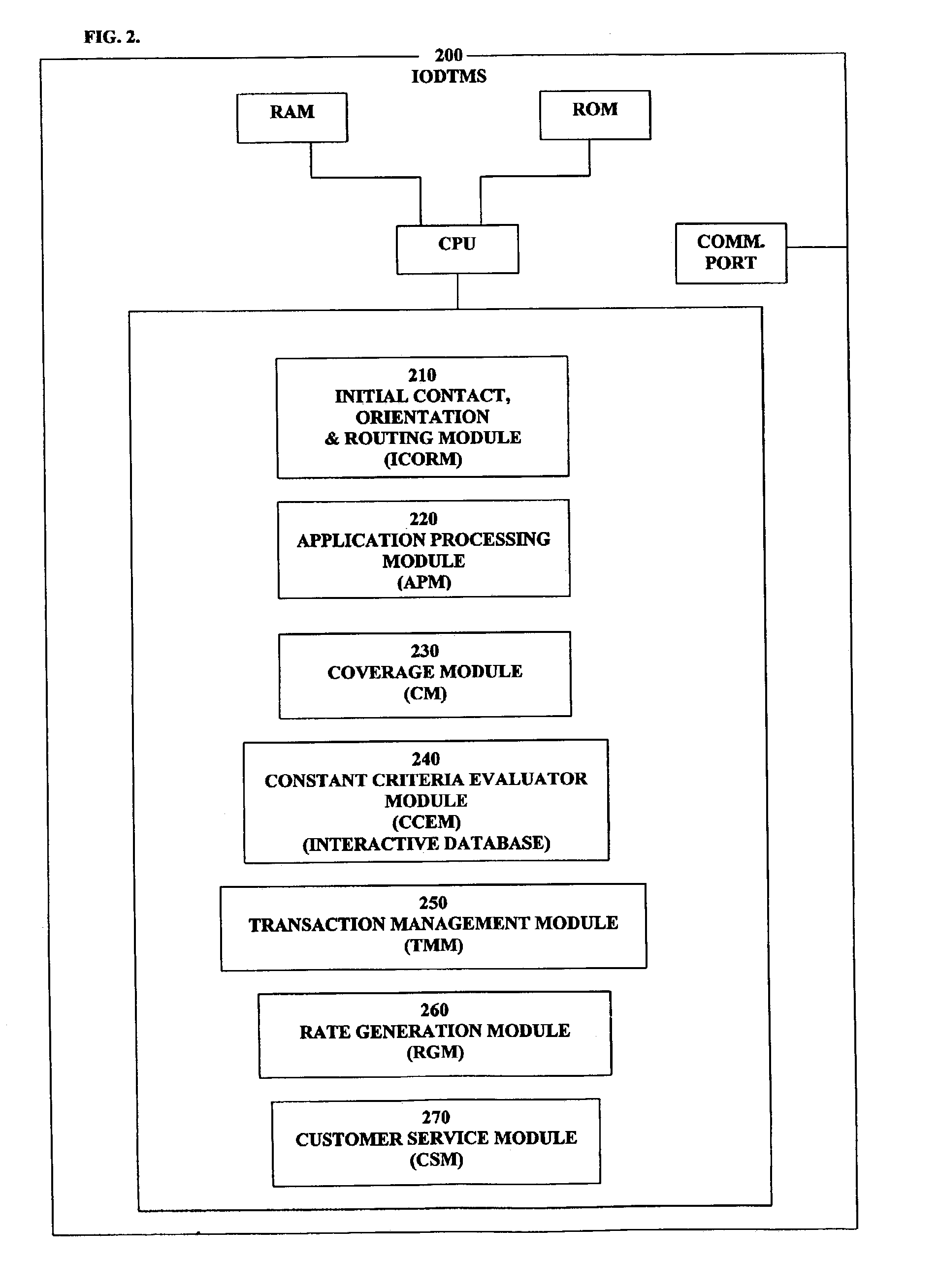

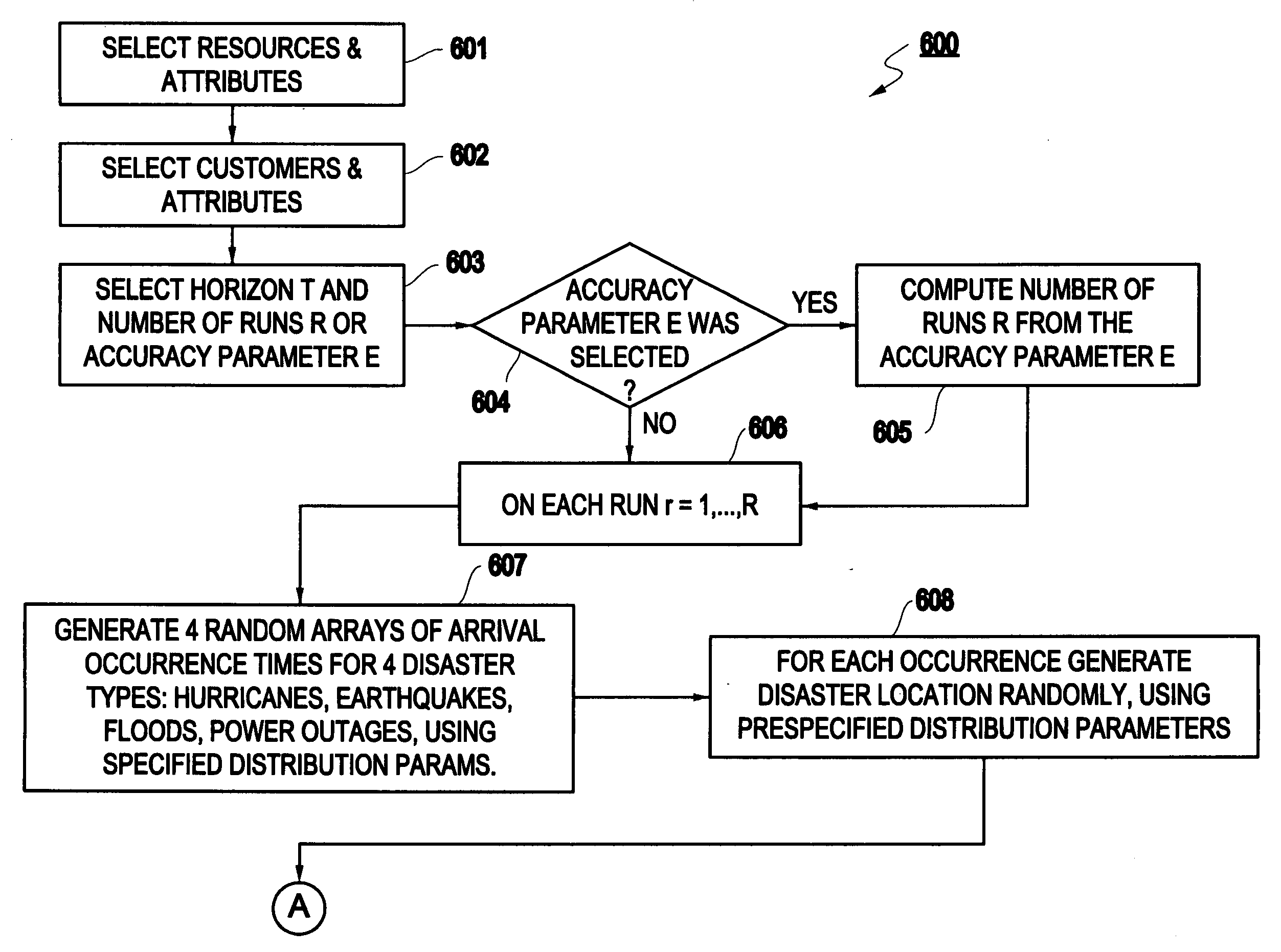

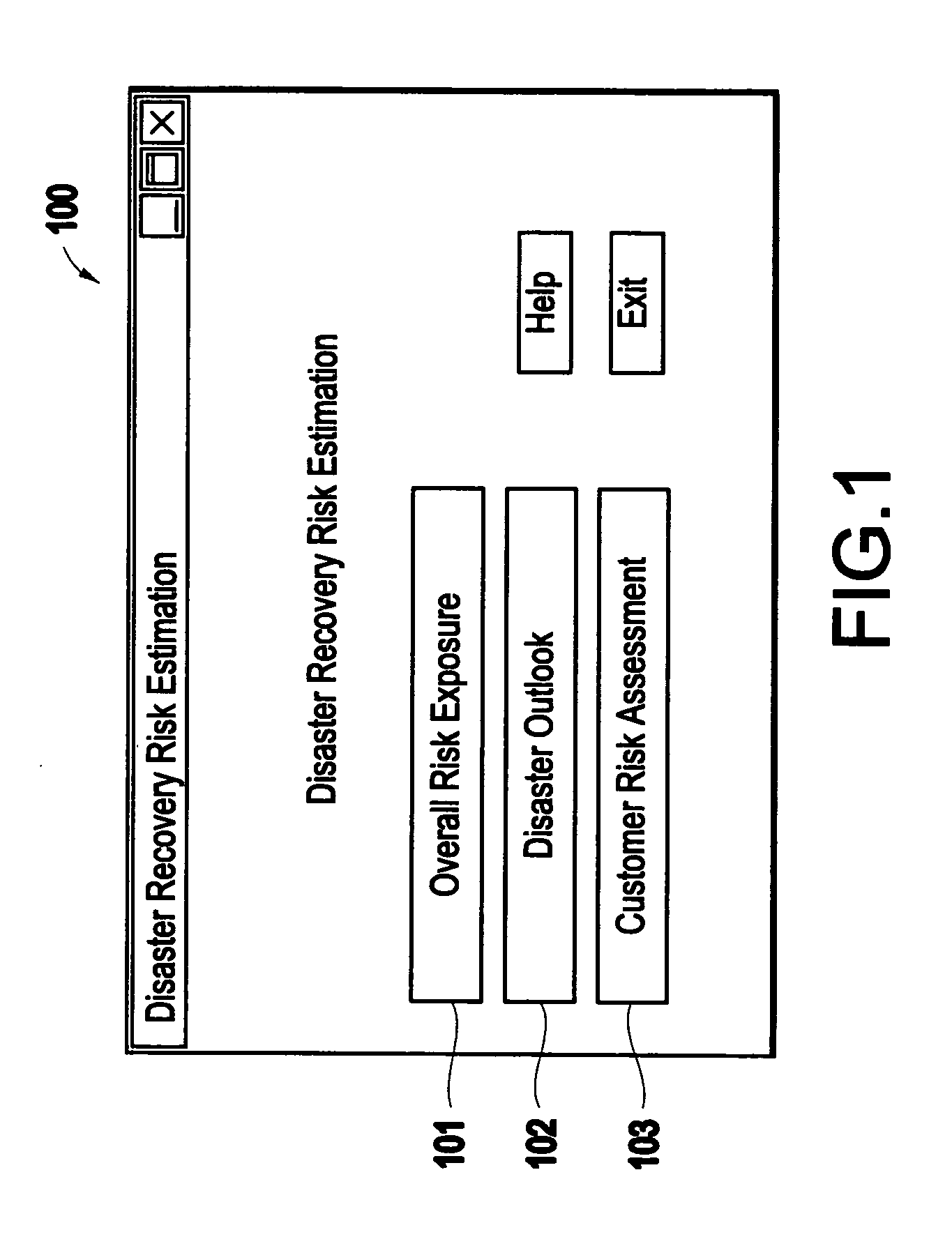

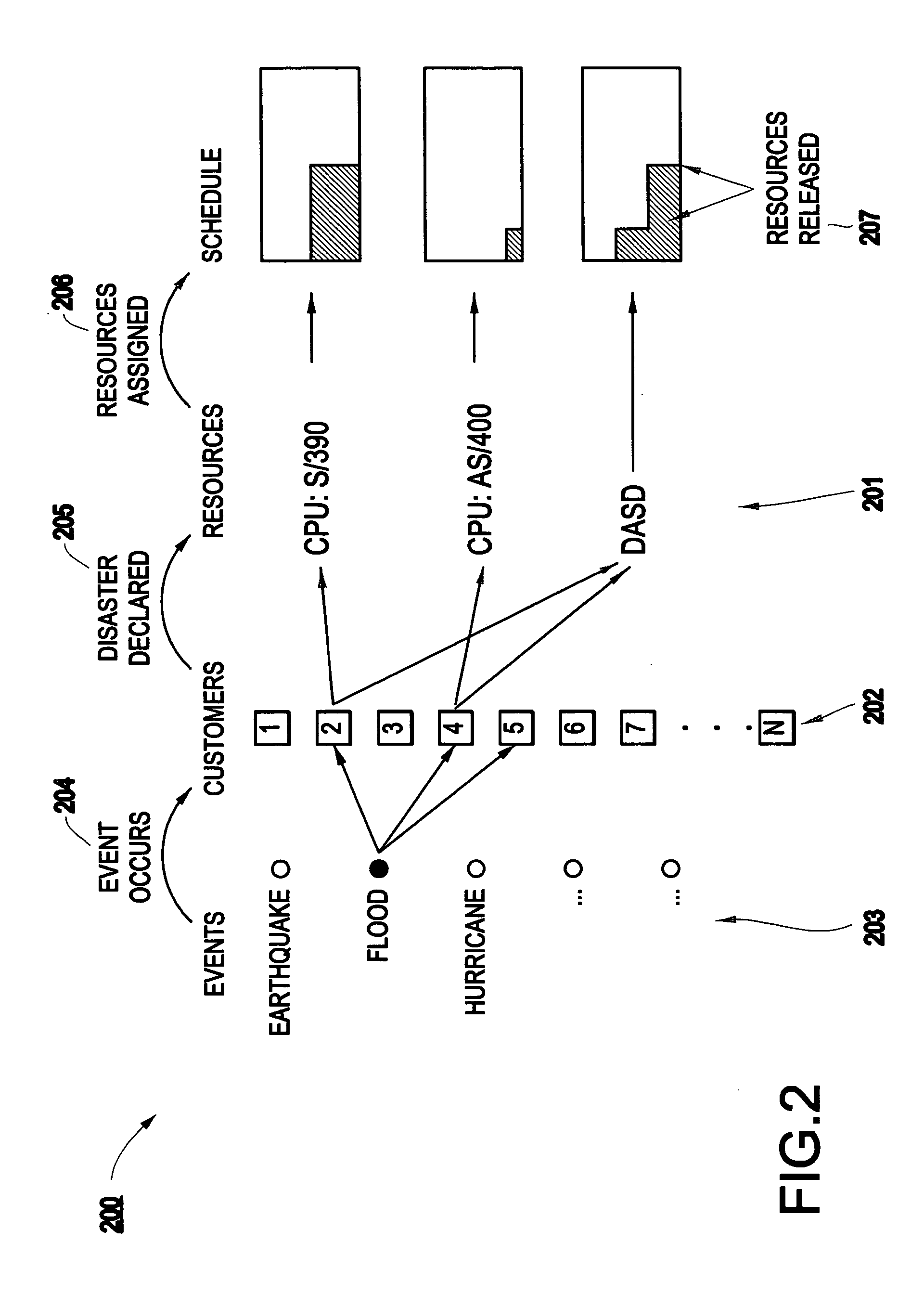

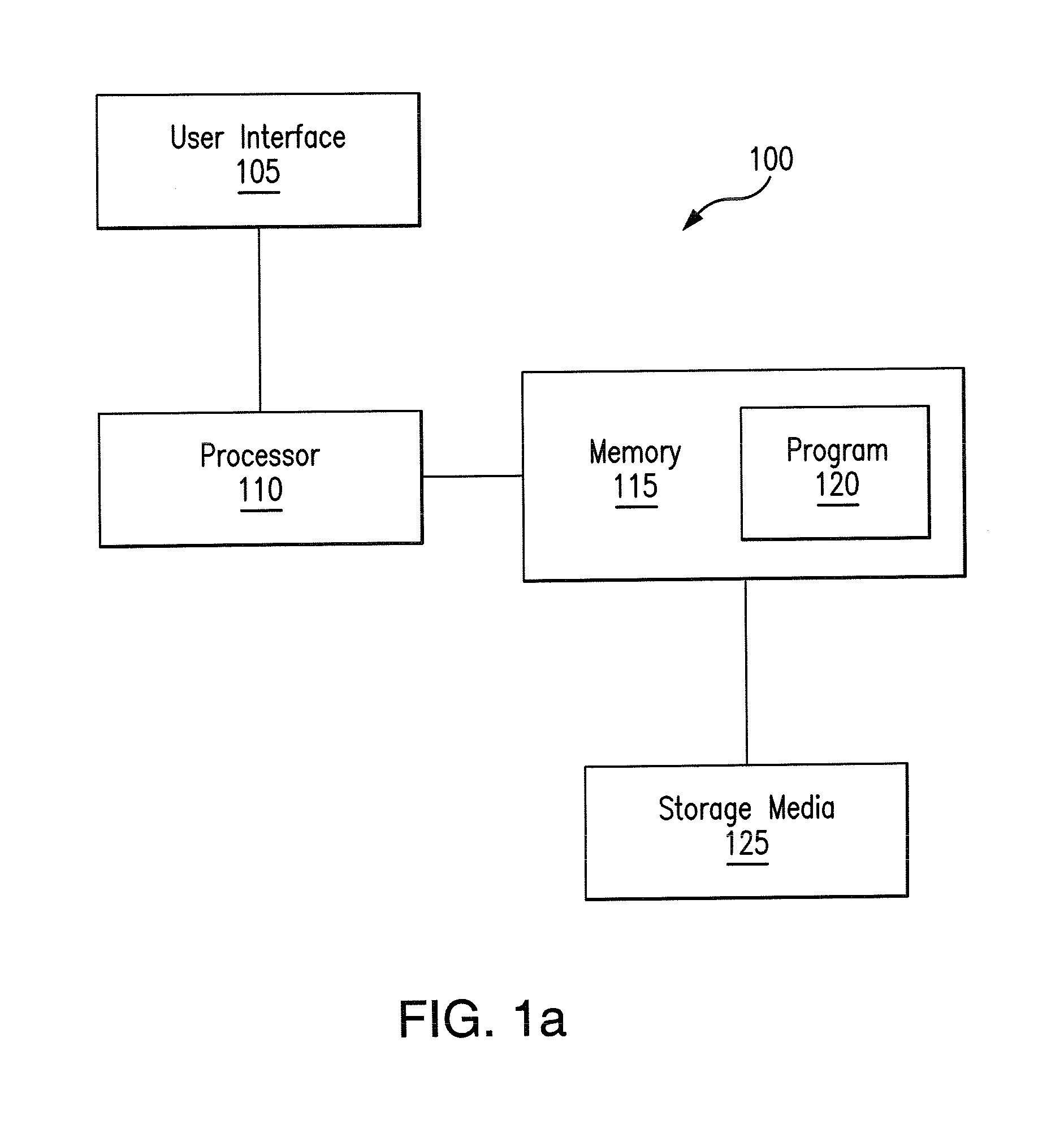

Method and apparatus for risk assessment for a disaster recovery process

InactiveUS20050027571A1Improve abilitiesGreat level of customer satisfactionFinanceElectric/magnetic detectionRisk exposureRisk model

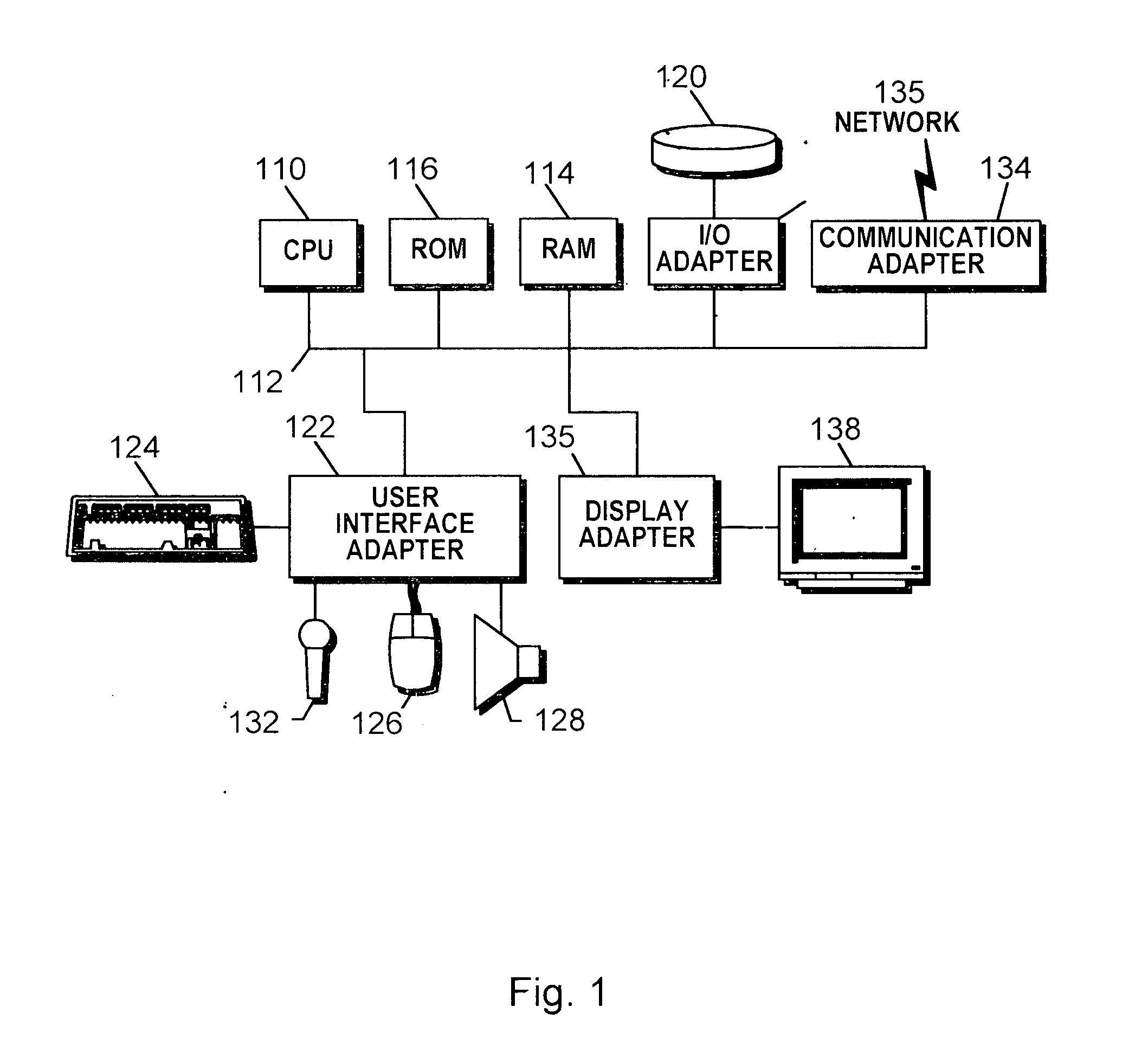

A method and structure for calculating a risk exposure for a disaster recovery process, including loading a user interface into a memory, the user interface allowing control of an execution of one or more risk models. Each risk model is based on a specific disaster type, and each risk model addresses a recovery utilization of one or more specific assets identified as necessary for a recovery process of the disaster type. One of the risk models is executed at least one time.

Owner:IBM CORP

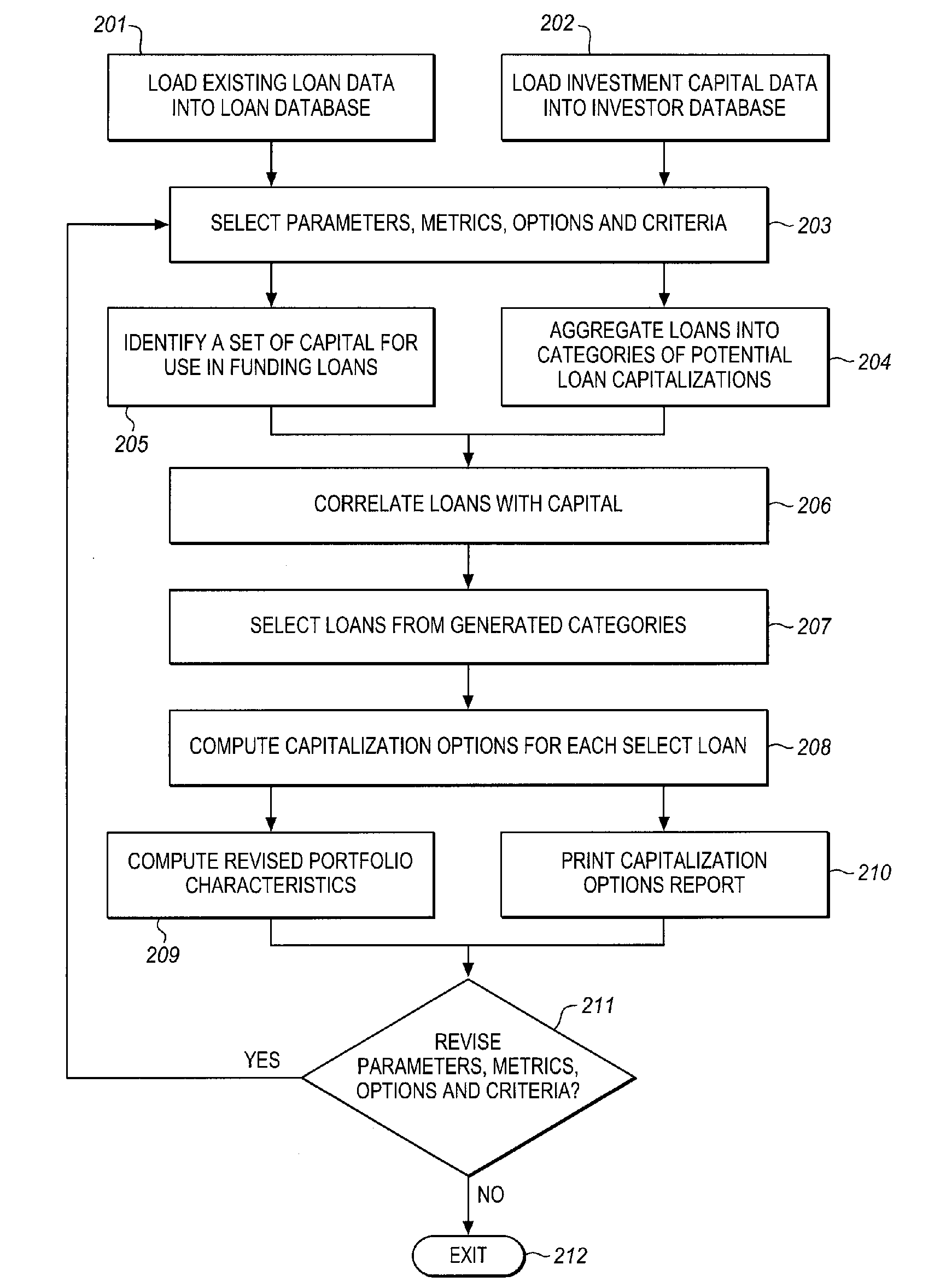

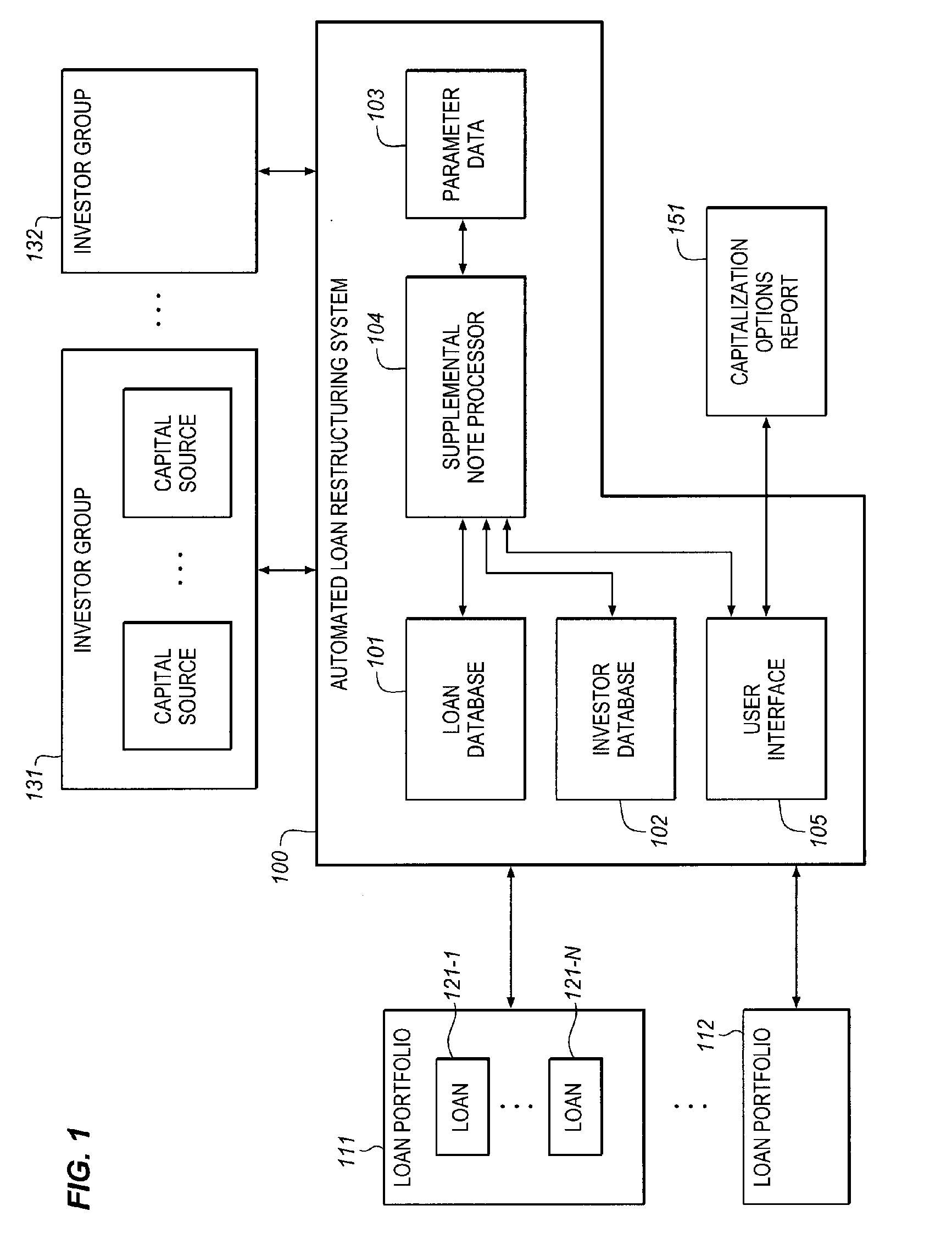

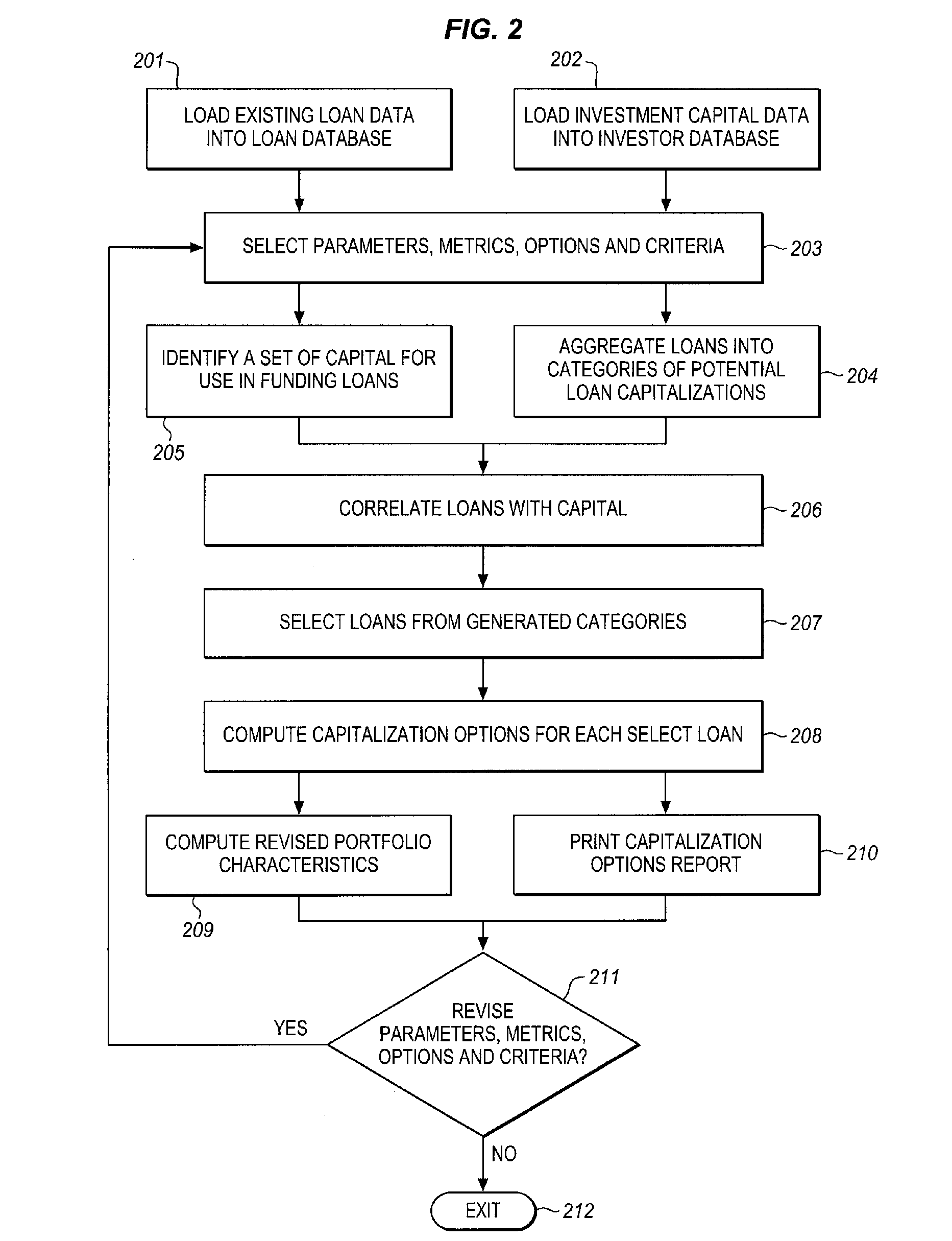

Automated system for compiling a plurality of existing mortgage loans for intra-loan restructuring of risk via capital infusion and dynamic resetting of loan terms and conditions

InactiveUS20100198743A1Facilitates extension of maturitySignificant positive effectFinanceRisk exposureRisk profiling

The CapStratix System operates on a plurality of existing loans (a “designated portfolio”), held by a regulated Lender, using a pool of capital which is available from unregulated Investors, to dynamically re-compute loan packages. The CapStratix System arranges for the disaggregation of a Lender's designated portfolio of Mortgage Loans, each into discrete note amounts, including an A Note and a “RenuNote”, both (or all) secured by the same mortgage lien. This process facilitates the extension of the maturity dates of the loans, at new market pricing, and the restatement of other terms and conditions required for a successful sale of the RenuNote to an Investor, reducing Lender's assets and risk profile, thereby having a positive effect on a Lender's regulatory capital ratios, without requiring a change to the Borrower's ownership structure or risk exposure.

Owner:CAPSTRATIX CAPITAL

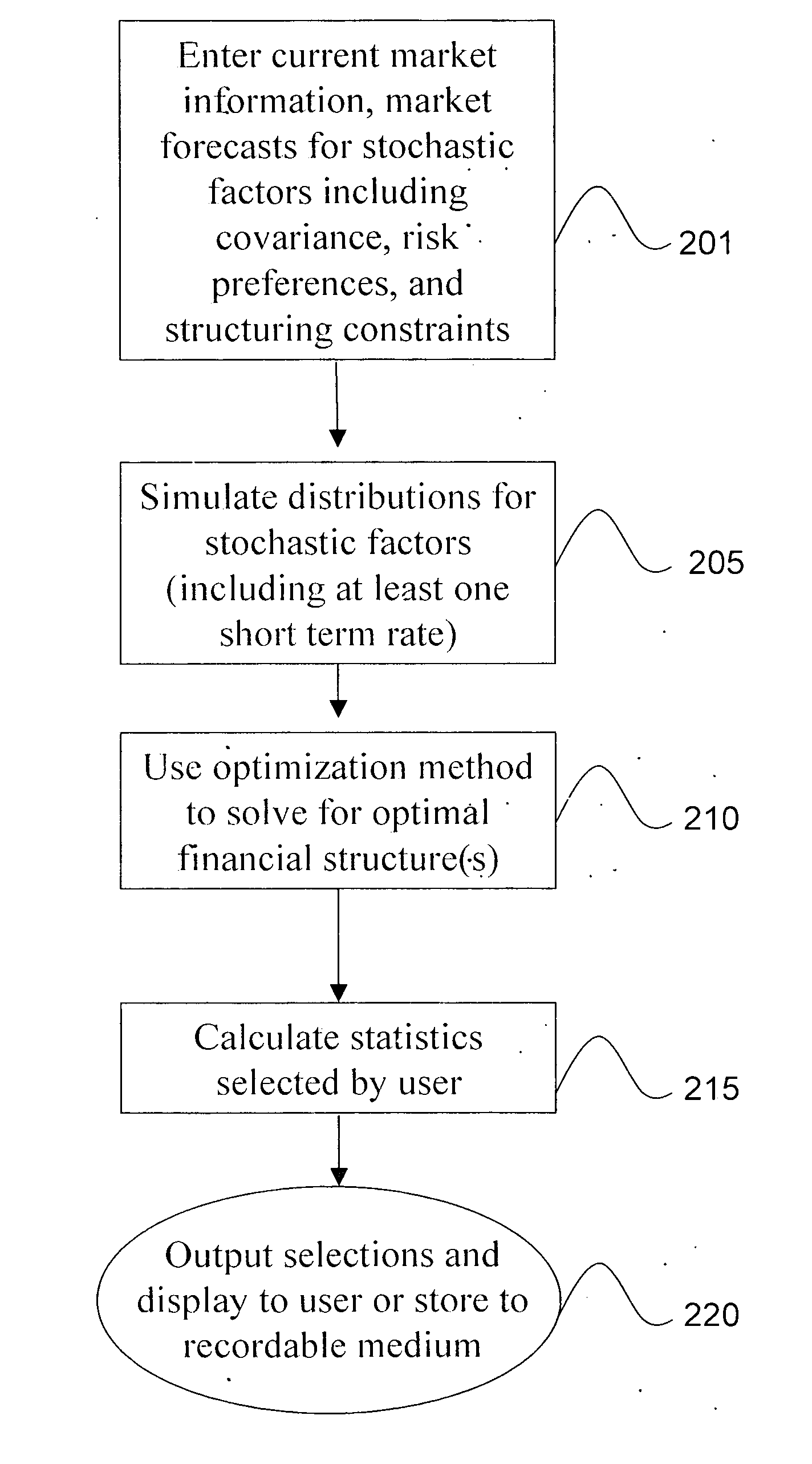

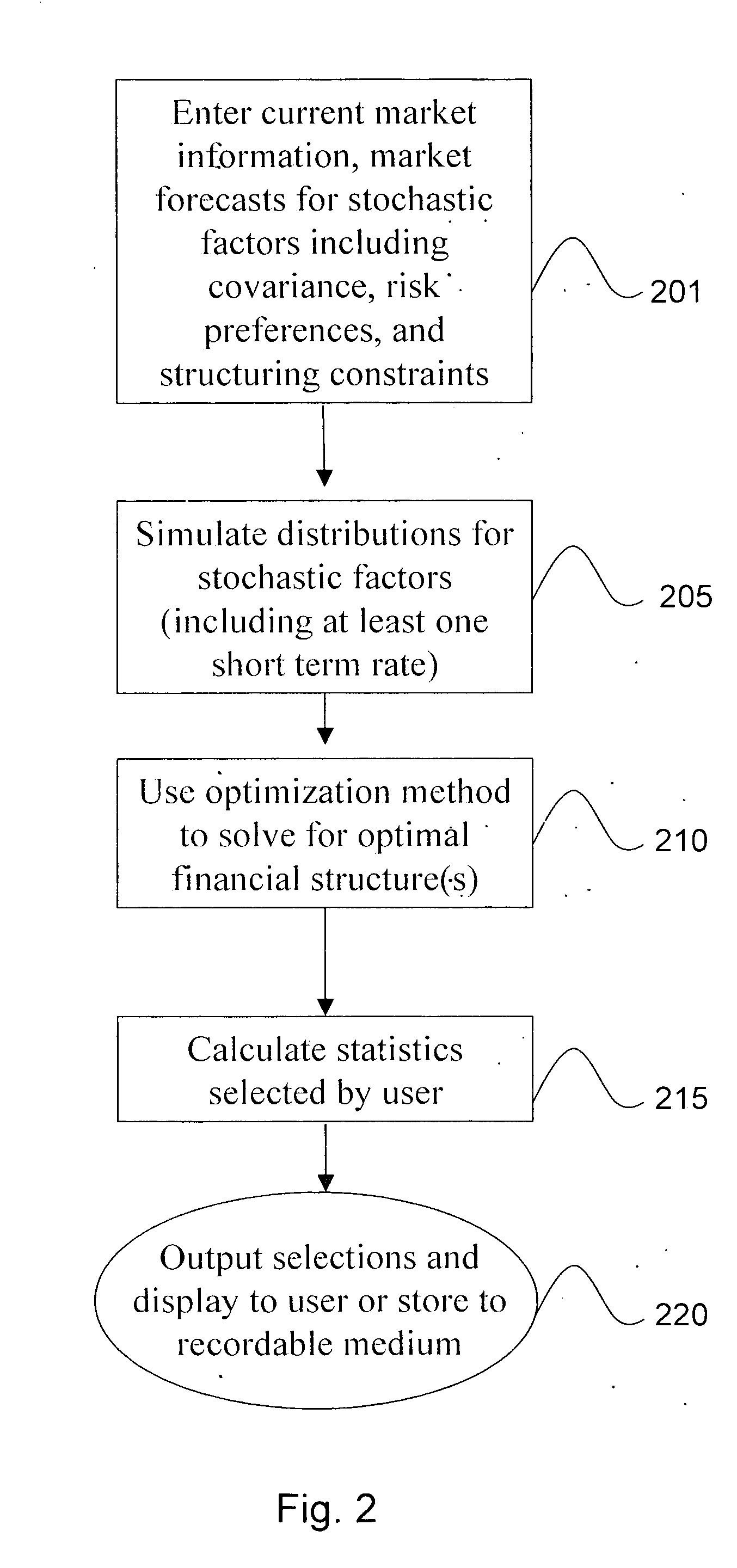

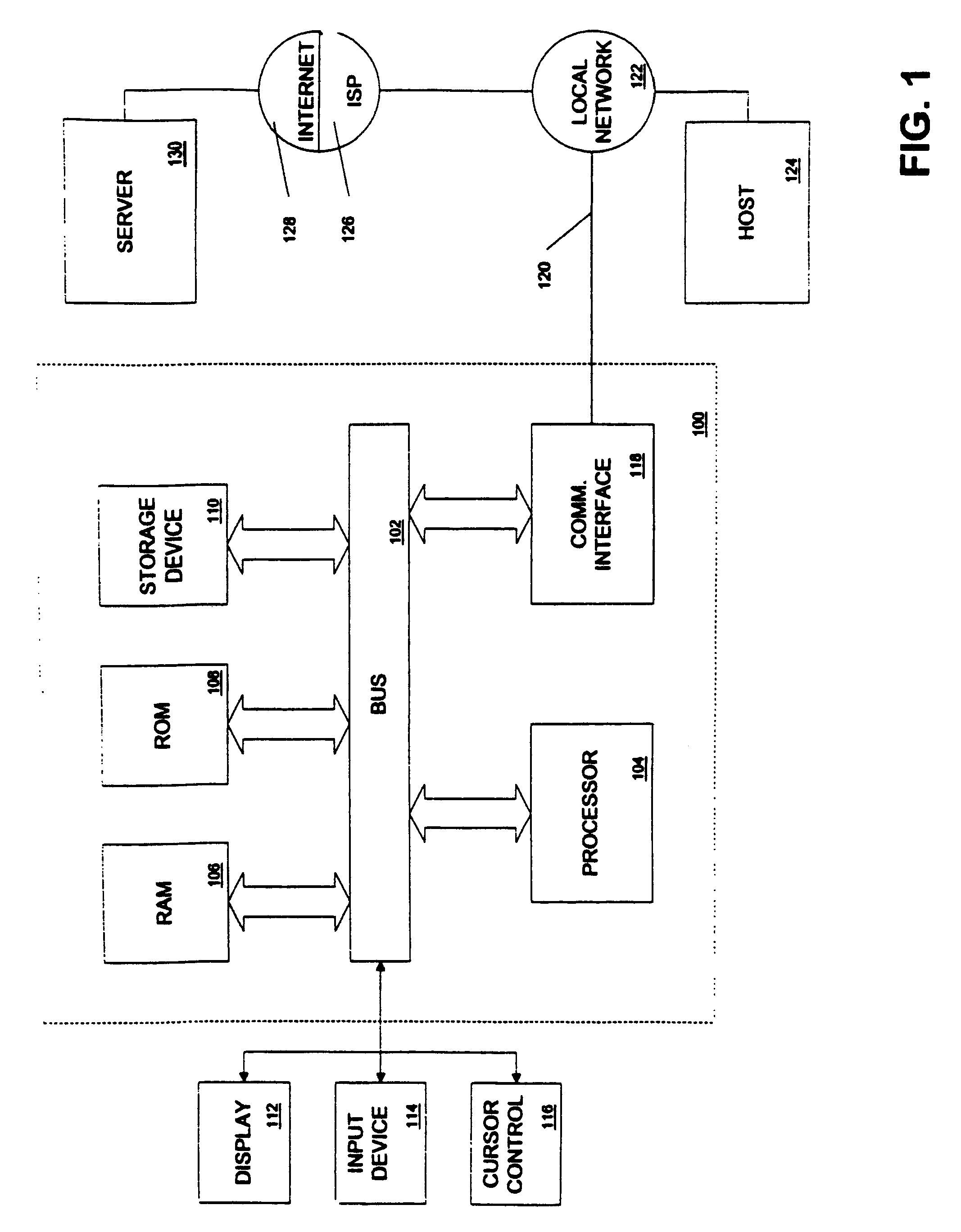

Systems, methods and programs for determining optimal financial structures and risk exposures

A model for analyzing a cashflow sensitive instrument is described that uses an optimization model of a data set associated with a cashflow sensitive instrument, which optimization model is based at least in part on an interest rate model and a cash-flow model. The interest rate model is at least partially based on at least one random variable used to simulate an underlying distribution on at least one interest rate. A model output is then generated based on the optimization model. The model outputs all optimal cashflow solution for the cashflow sensitive instrument(s) that at least partially optimizes factors of risk and / or cost. Related methods, programs and systems are also provided.

Owner:INTUITIVE ANALYTICS

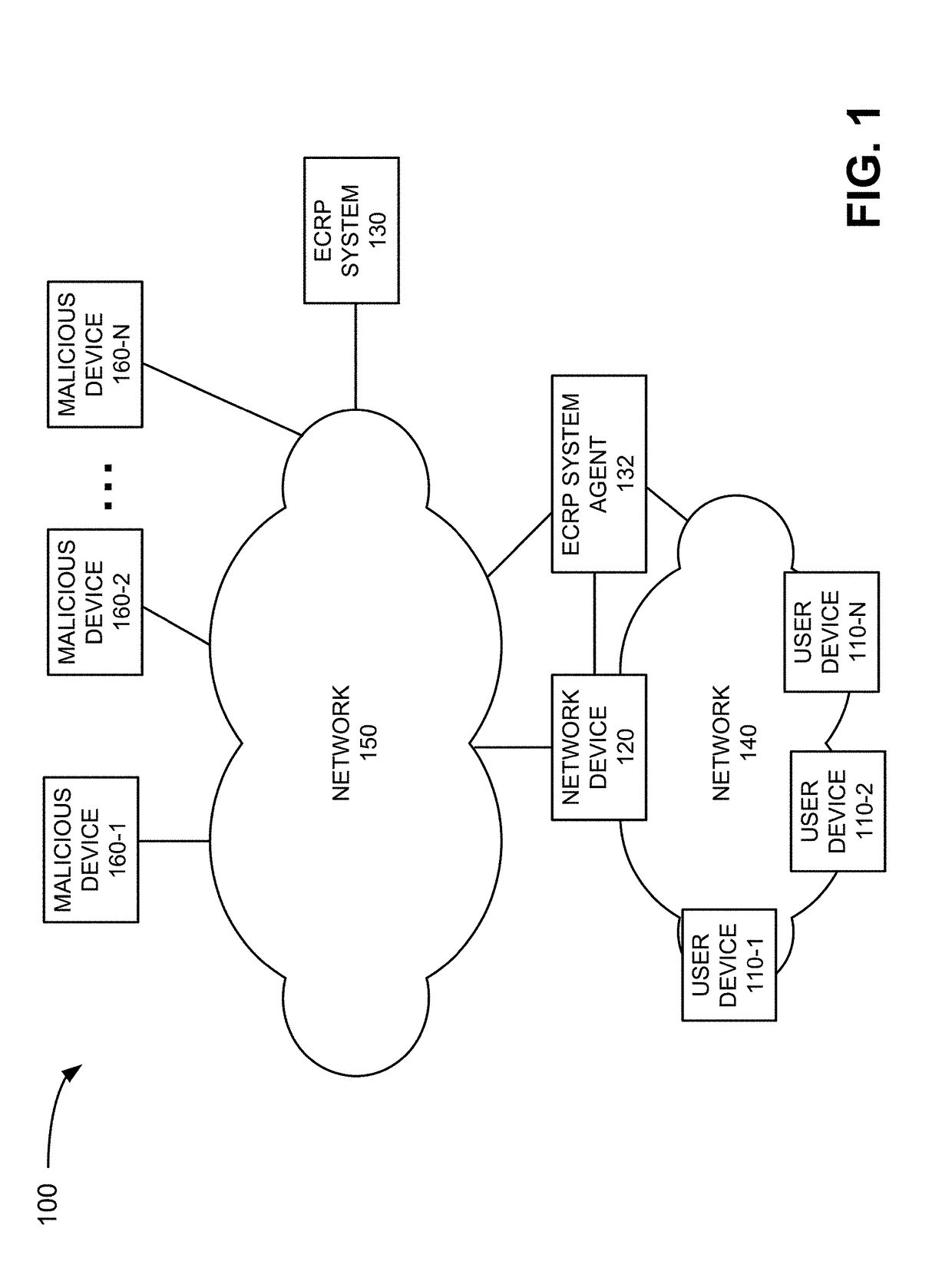

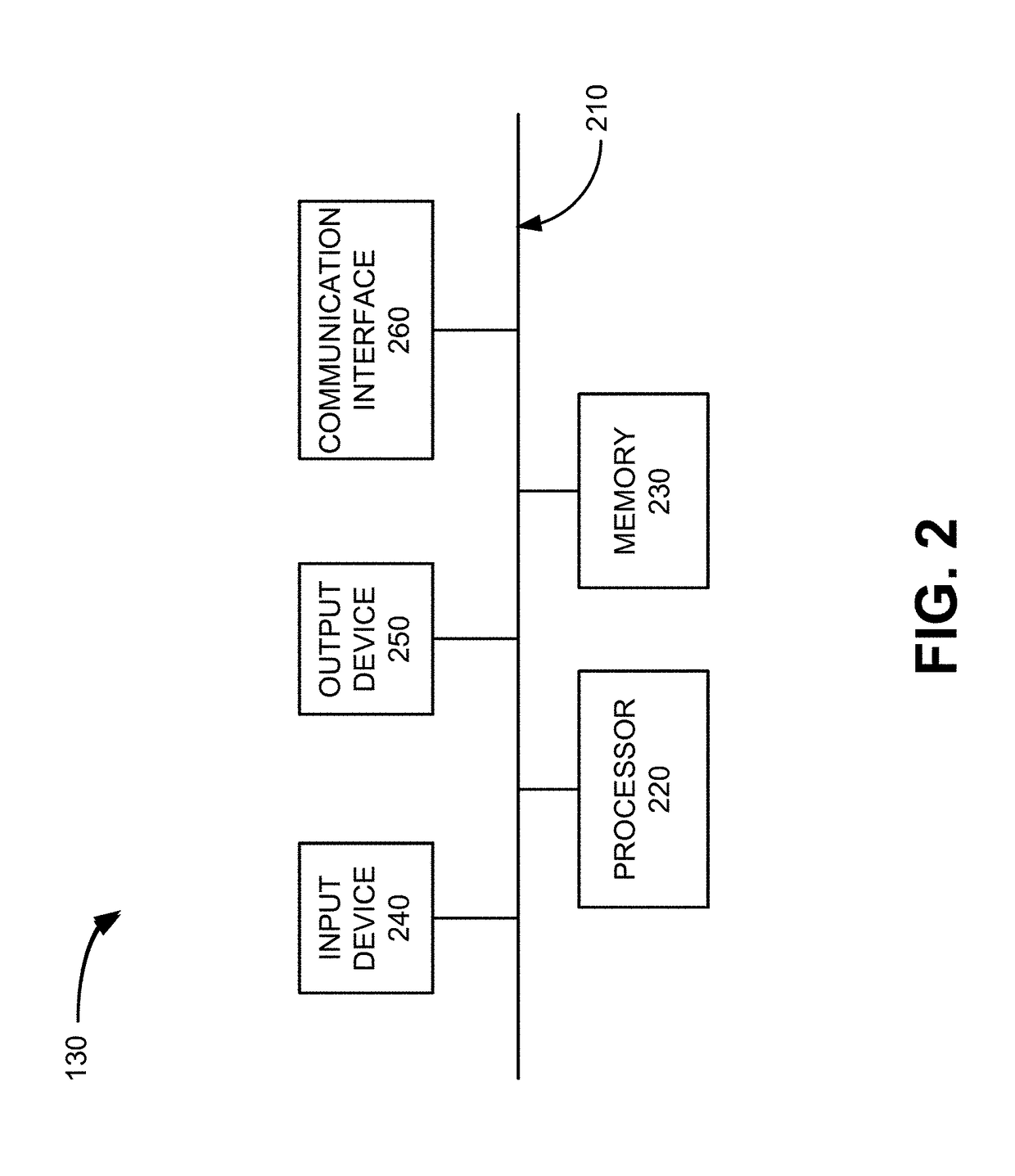

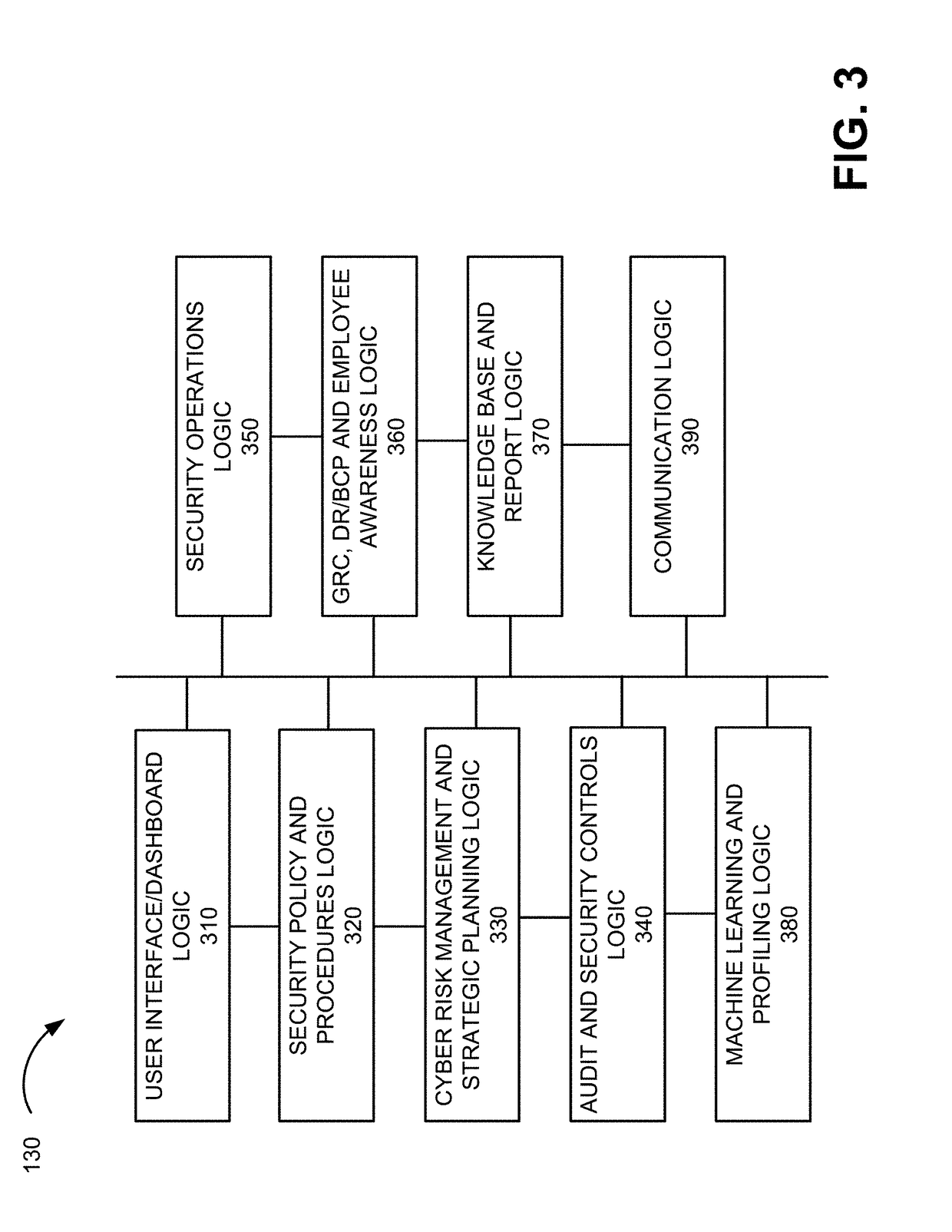

Enterprise cyber security risk management and resource planning

A system includes a memory to store network-related security policies and procedures associated with an enterprise, a display and at least one device. The device is configured to monitor enterprise activity associated the enterprise's networked and determine, based on the enterprise activity, whether the enterprise is complying with the security policies and procedures. The device is also configured to calculate a risk exposure metric for an asset of the enterprise based on the enterprise activity and whether the enterprise is complying with the security policies and procedures, and output, to the display, a graphical user interface (GUI) identifying the risk exposure metric. The device may also be configured to receive, via the GUI, an input to initiate a change with respect to at least one of the enterprise's networked devices or initiate the generation of a plan to make a change to at least one of the networked devices.

Owner:CISOTERIA LTD

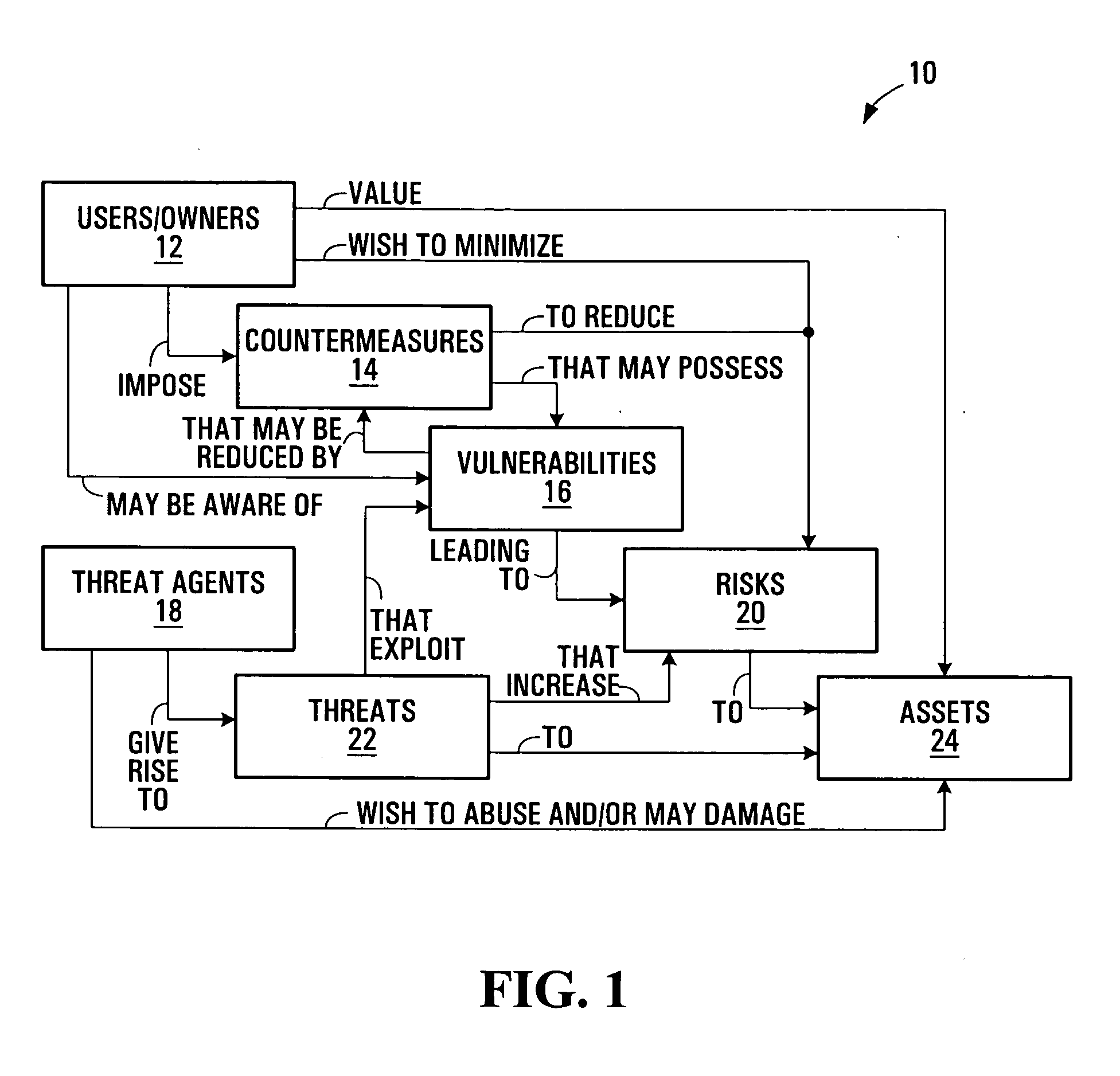

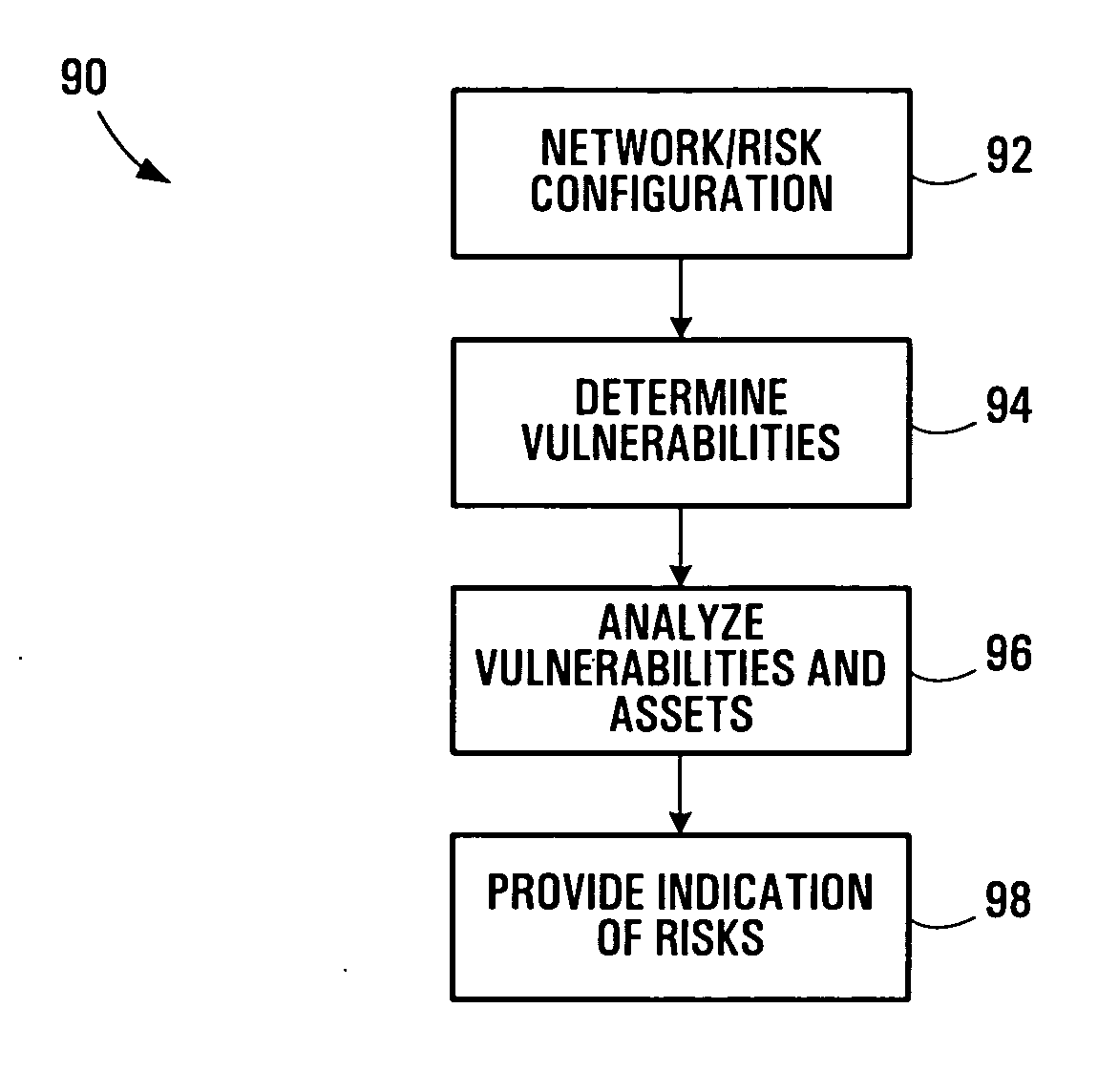

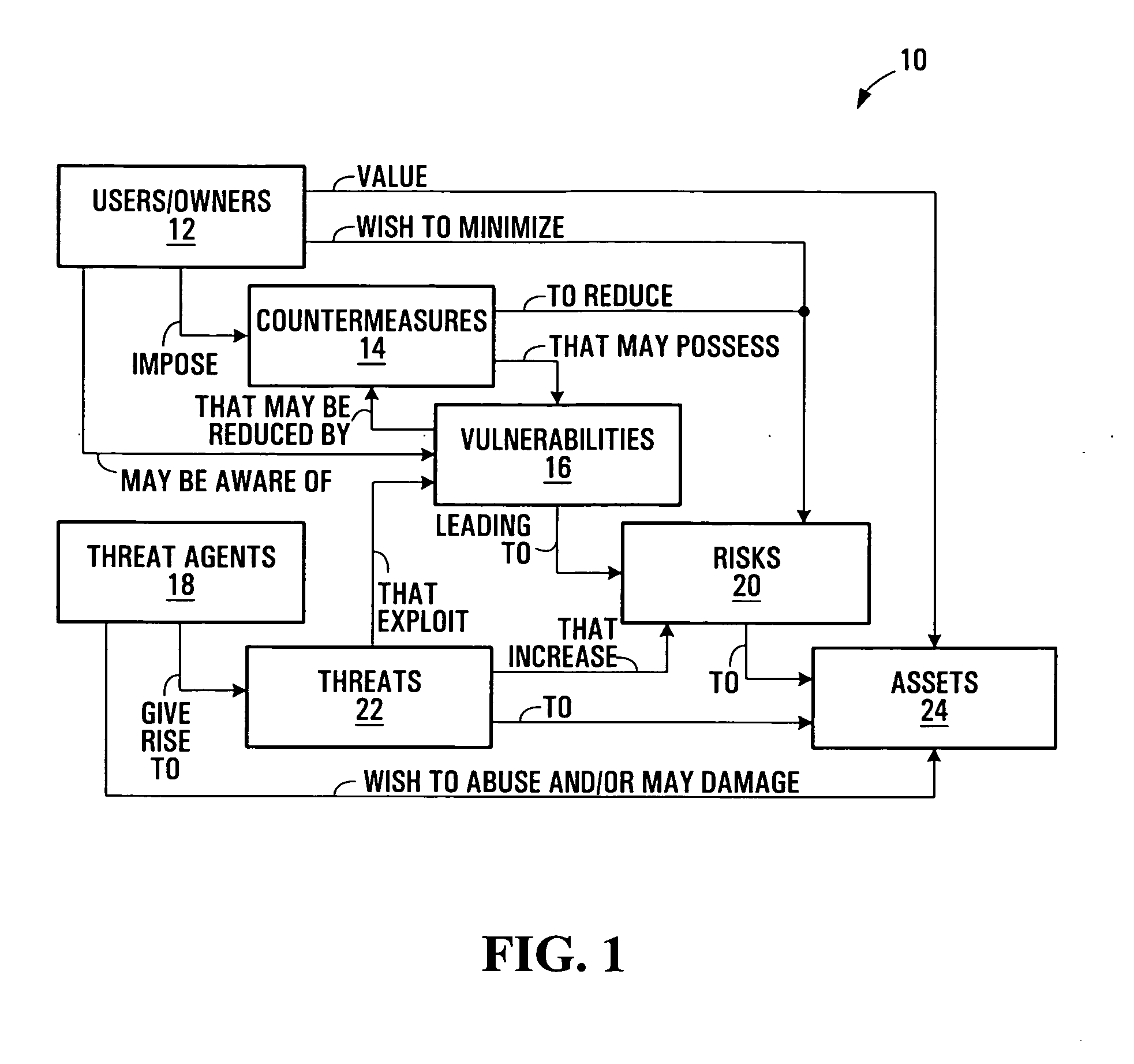

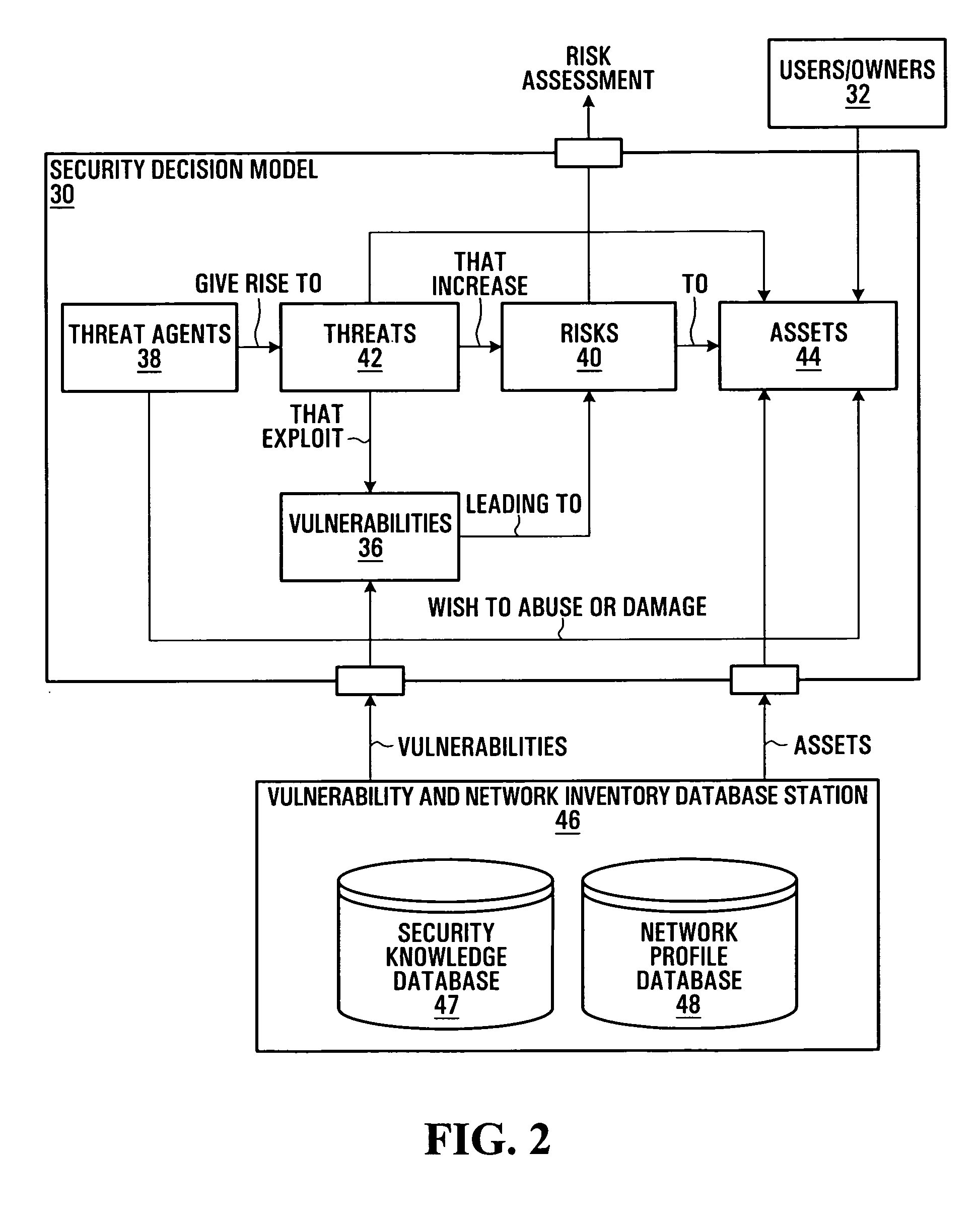

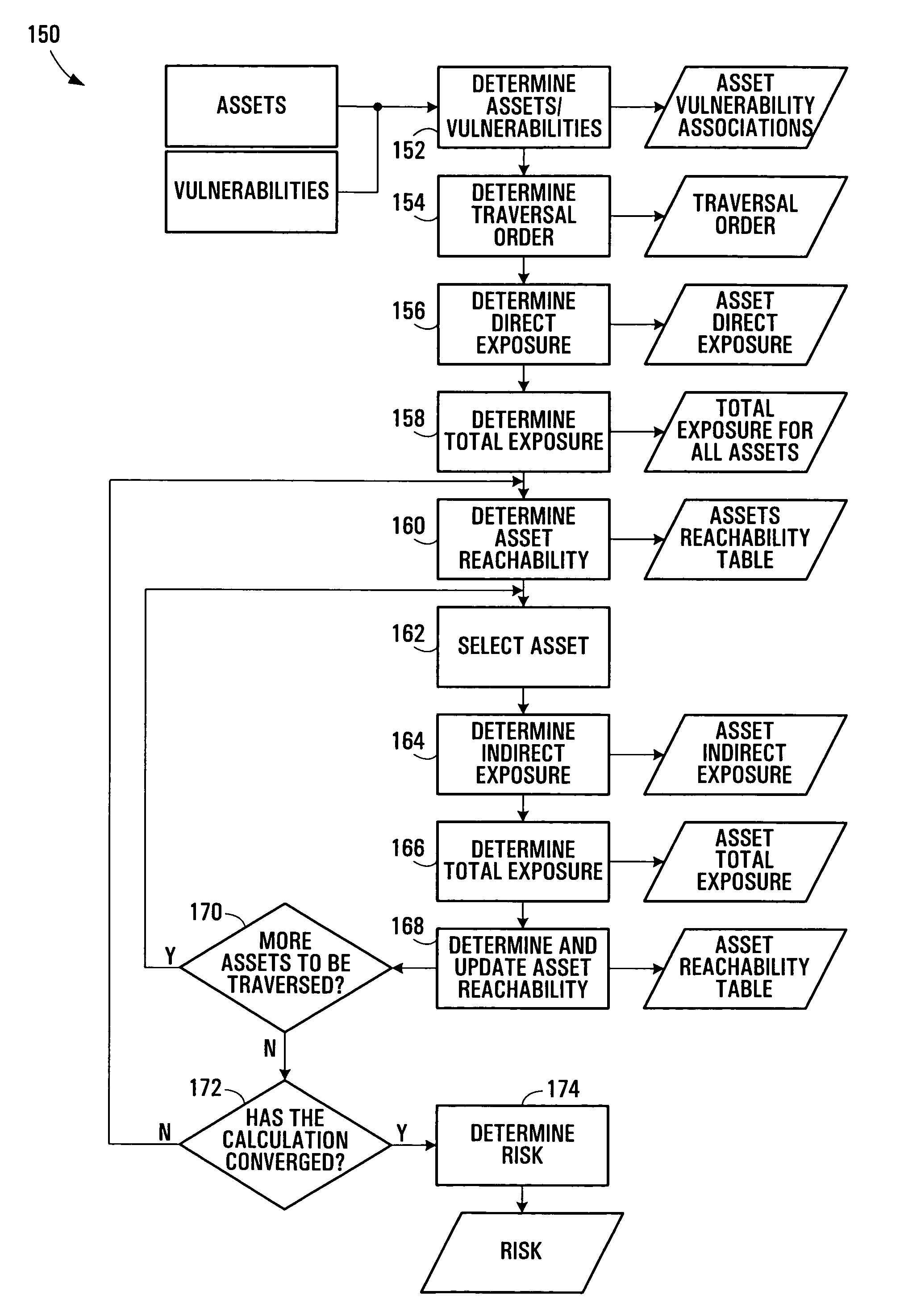

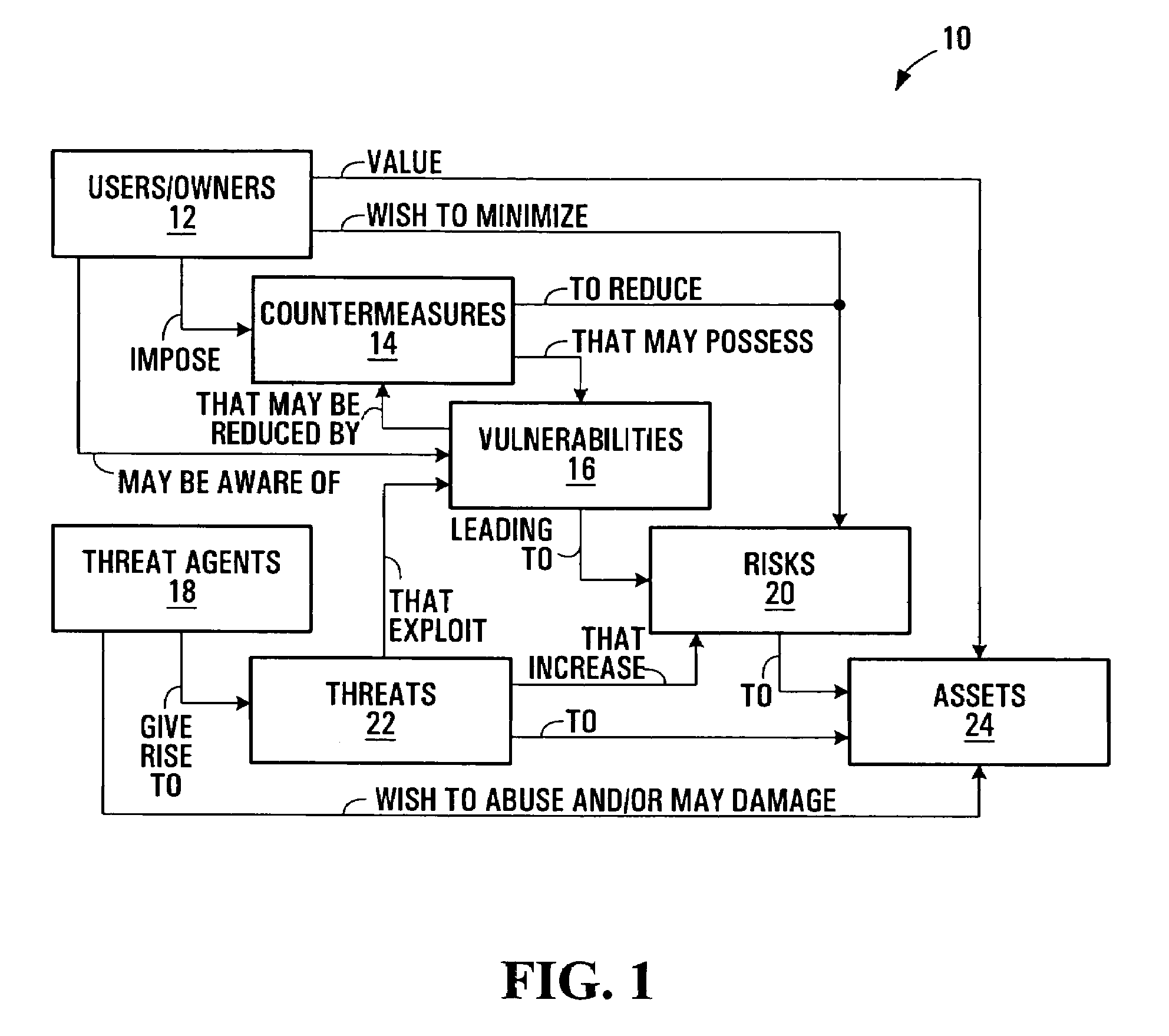

Security risk analysis systems and methods

Security risk analysis systems and methods are disclosed. Vulnerabilities affecting assets of a communication network are associated with other assets of the communication network according to relationships between assets. Security risk may thus be assessed on the basis of both vulnerabilities which directly affect assets and vulnerabilities which indirectly affect assets through their relationships with other assets. Risk exposure calculators which determine respective types of exposure of assets to vulnerabilities, illustratively direct and indirect exposures, are selectable so as to provide for customizable security risk analysis.

Owner:ALCATEL LUCENT SAS

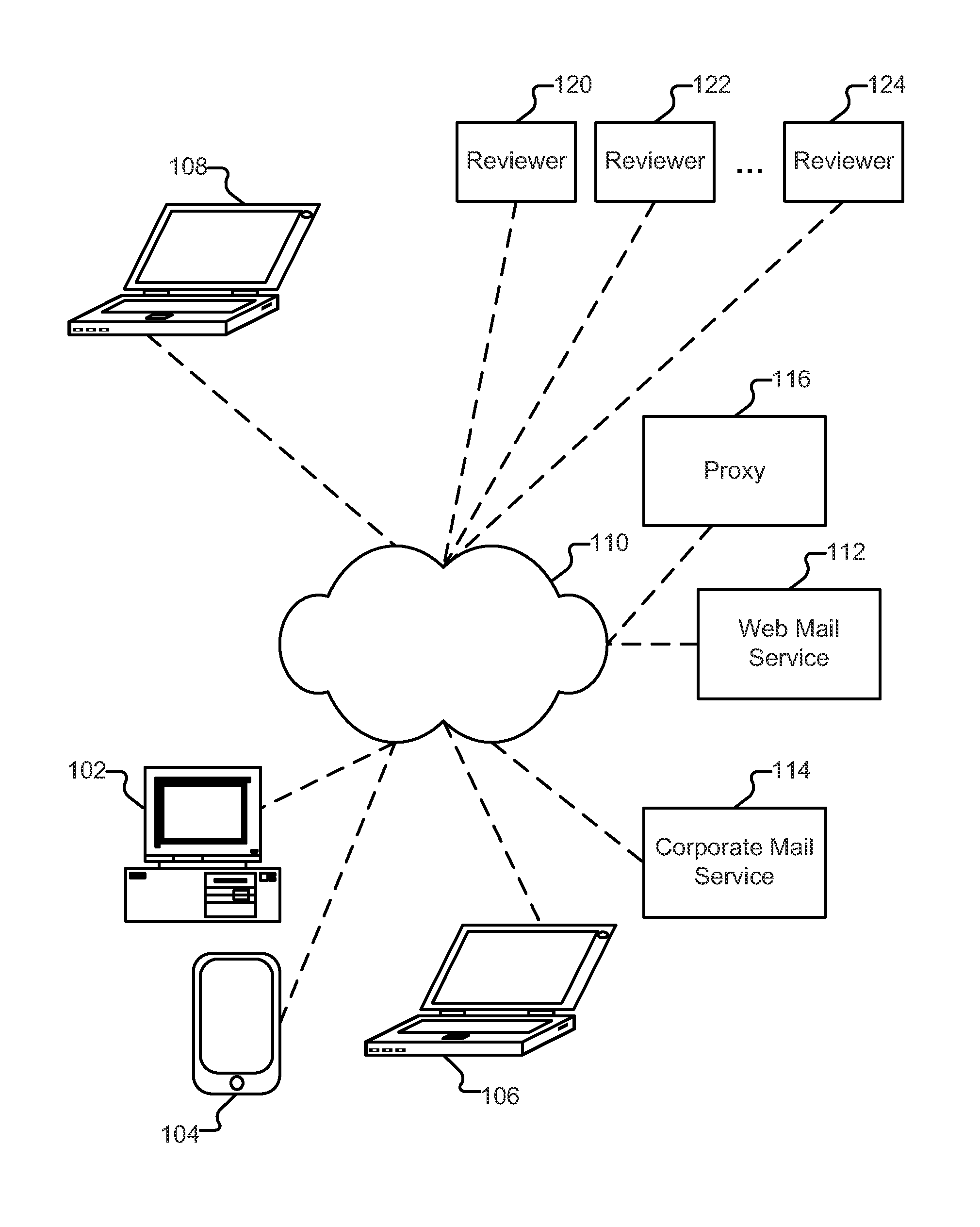

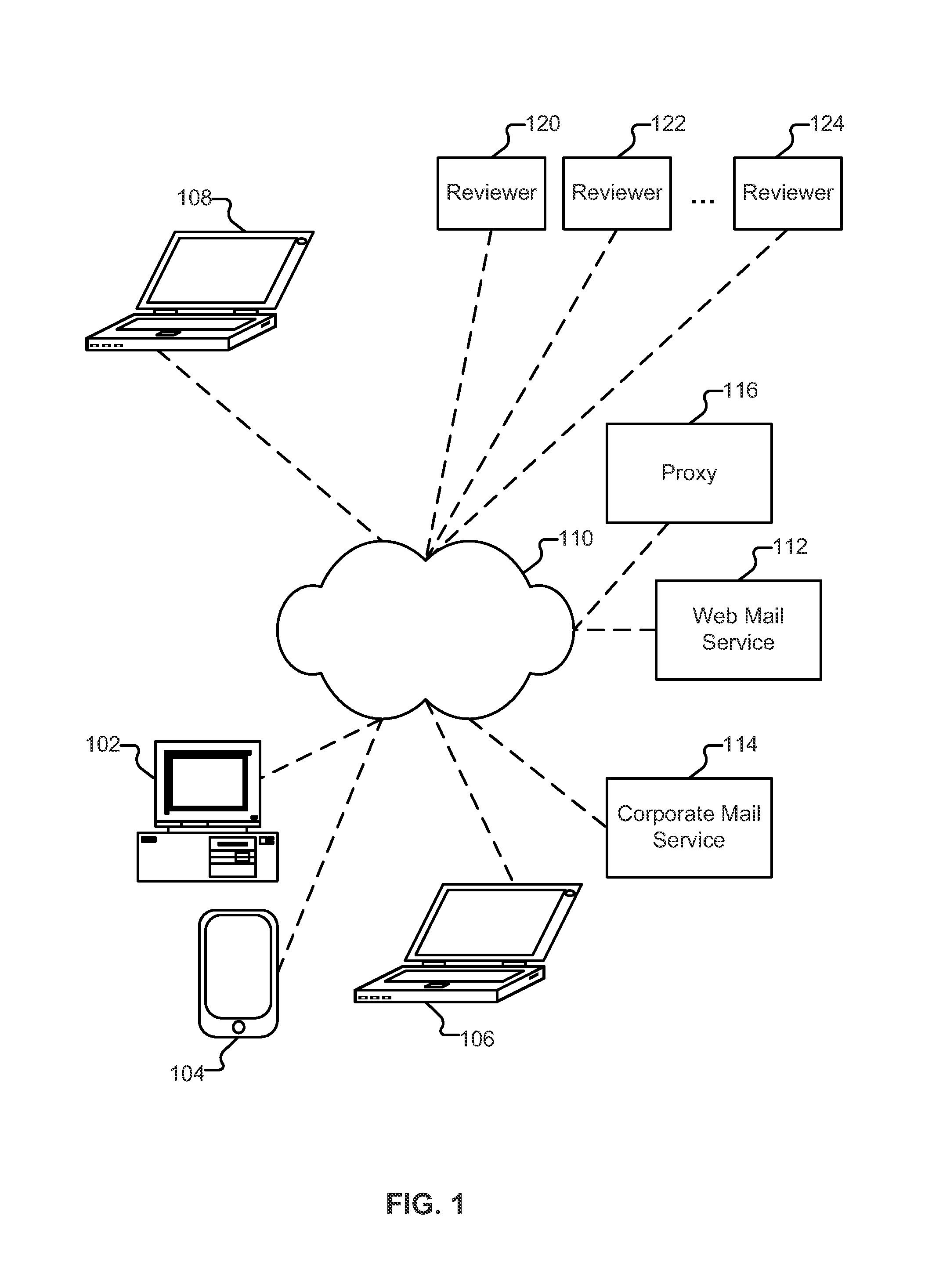

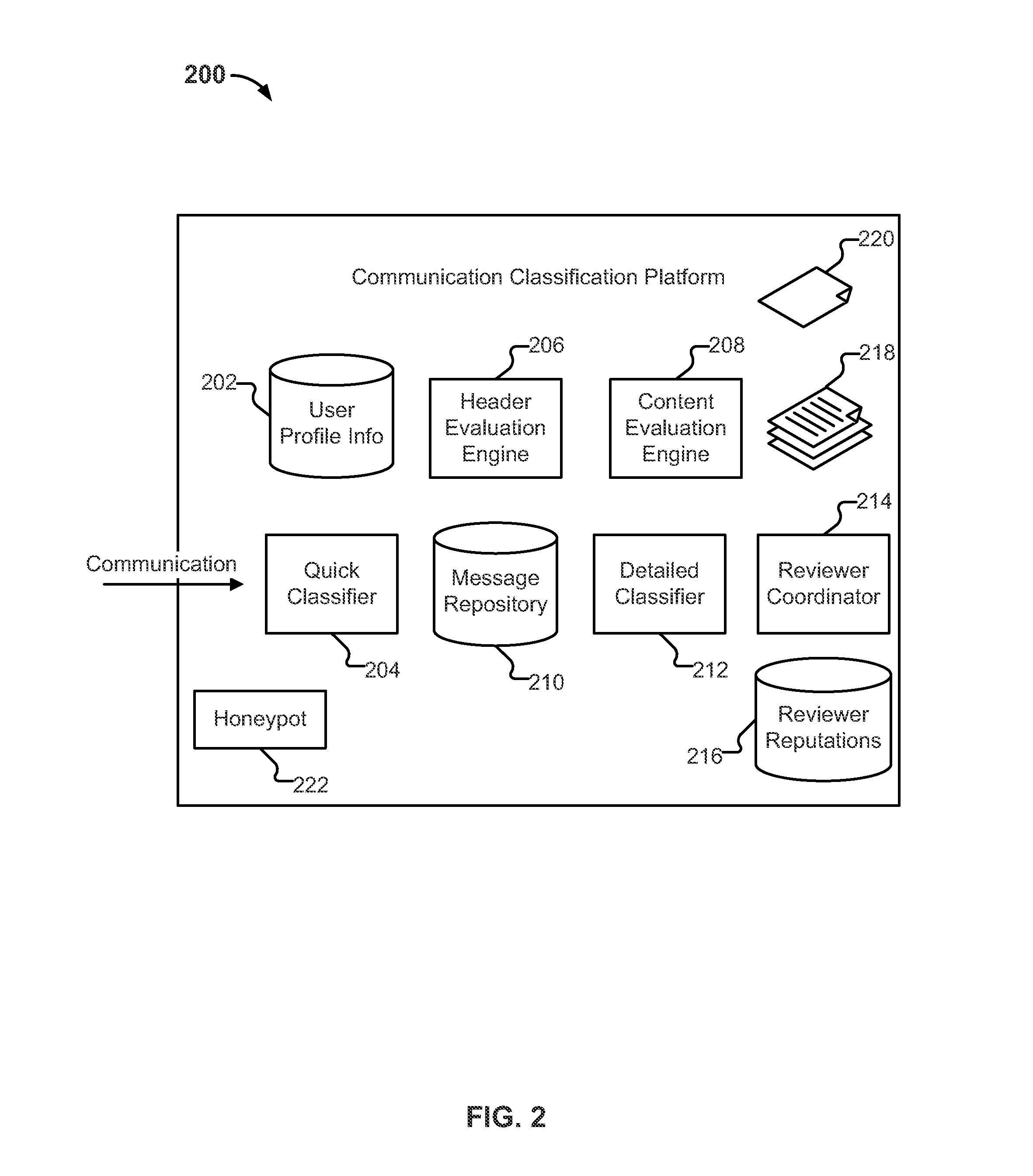

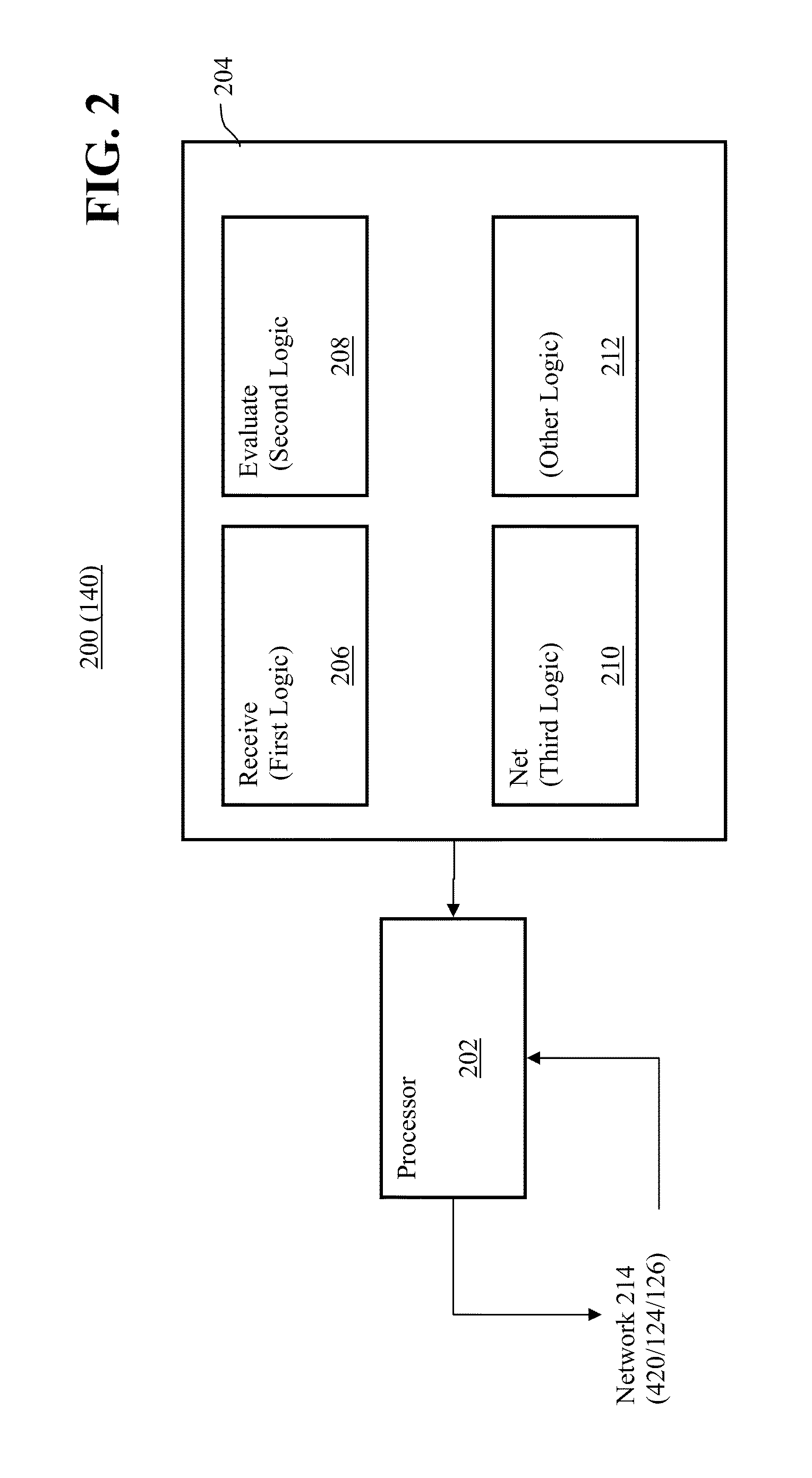

Determining risk exposure and avoiding fraud using a collection of terms

Classification of electronic communications includes receiving an electronic communication, evaluating the received communication against a collection of terms, and classifying the received communication based at least in part on the evaluation. The collection of terms is representative of a particular strategy of an attacker. The evaluation includes determining a presence of a portion of the collection of terms in the electronic communication.

Owner:ZAPFRAUD

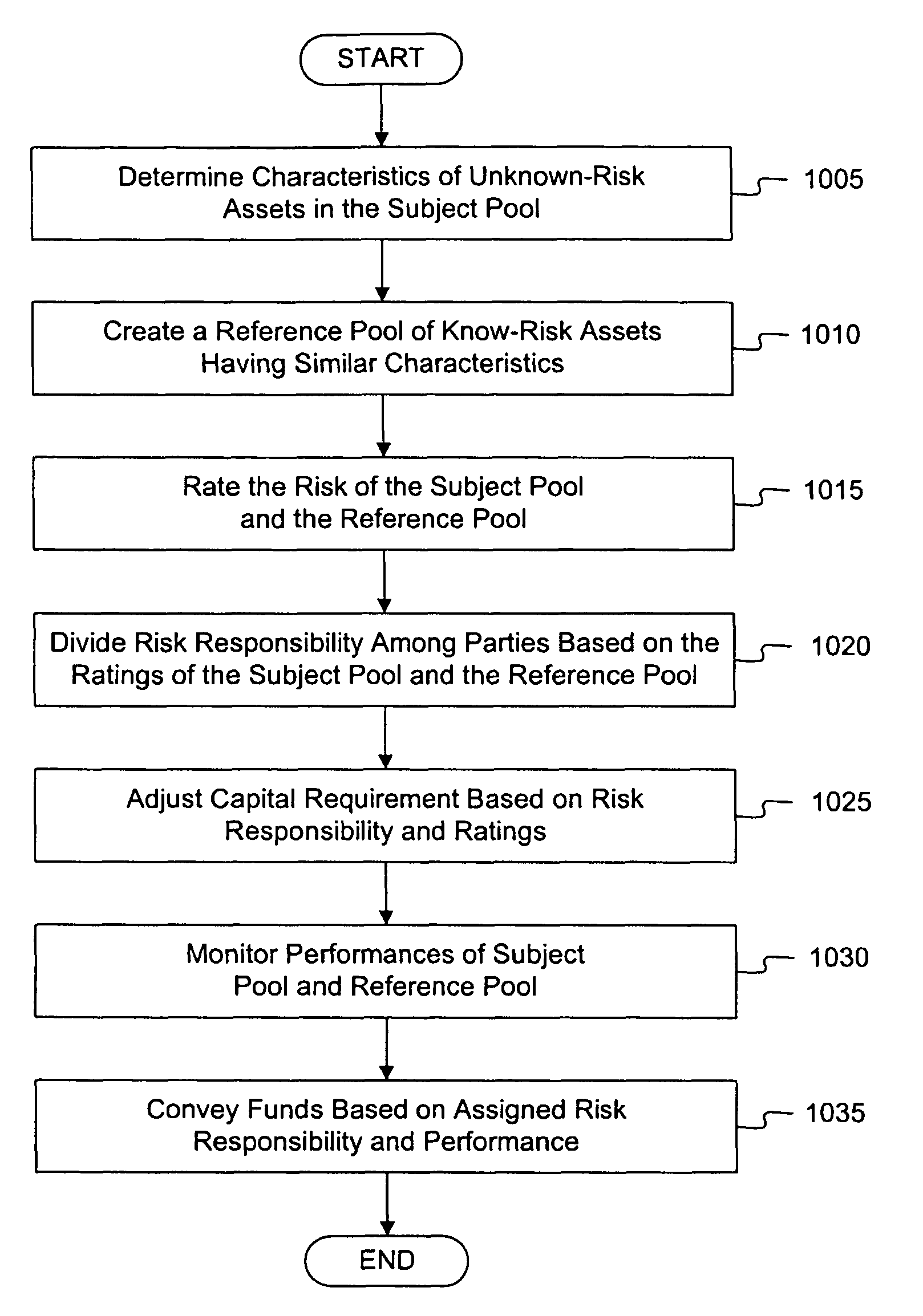

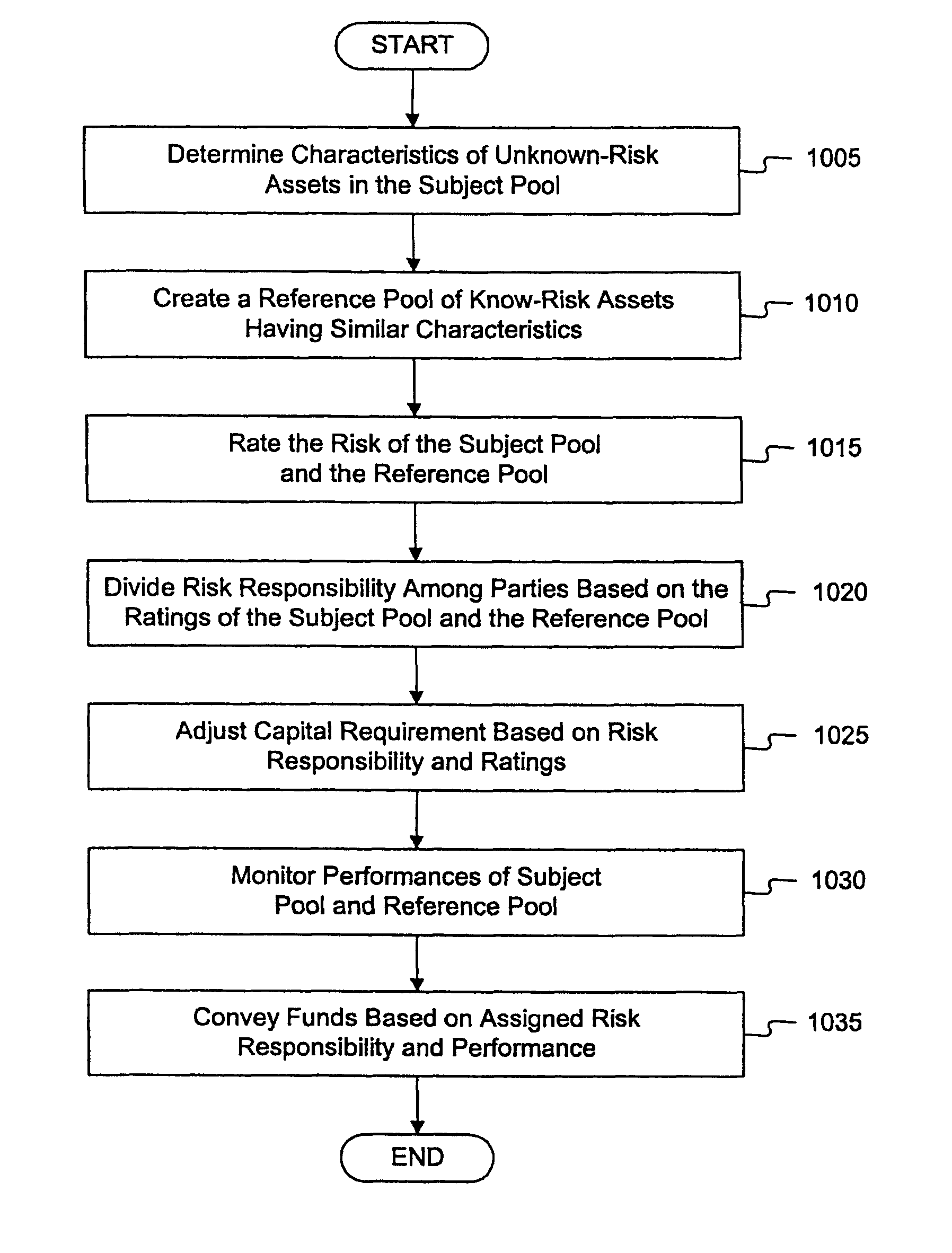

Risk-based reference pool capital reducing systems and methods

Embodiments consistent with the present invention provide a credit enhancement structure for risk allocation between parties that minimizes the regulatory capital reserve requirement impact to an institution subject to capital reserve requirement. A subject pool of assets held by the institution, such as a pool of loans, is rated to determine its risk levels. Based on the rated risk levels, a guarantor party agrees to be responsible for a portion of the risk associated with the pool of assets, which may define the maximum risk exposure of the institution holding the asset pool. The risk-rated capital reserve requirements are applied to the asset pool based on the risk level rating and the guarantor's agreed upon risk responsibility such that the institution holds a reduced amount of reserve capital compared to what it would otherwise be required to hold.

Owner:HEUER JOAN D +6

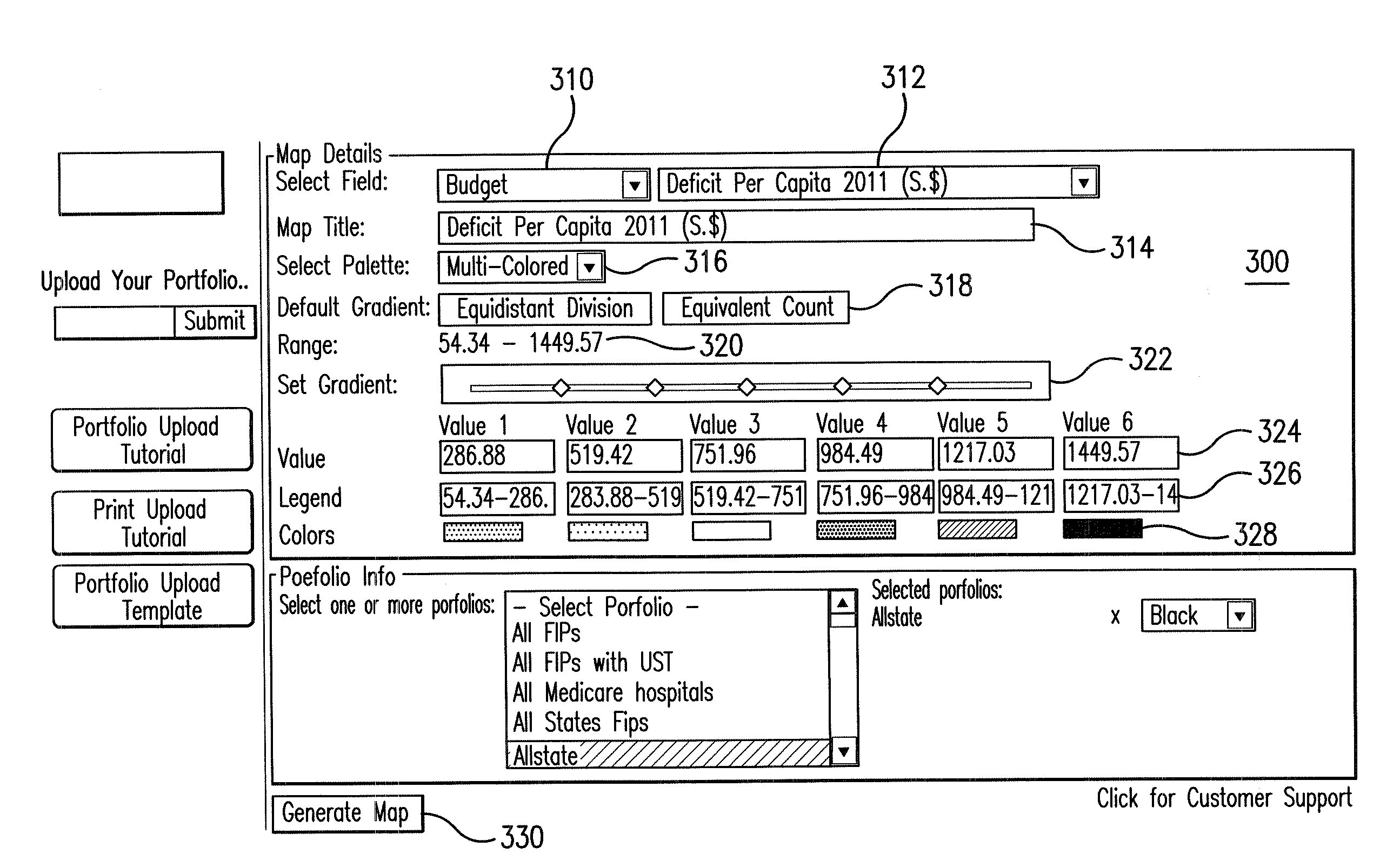

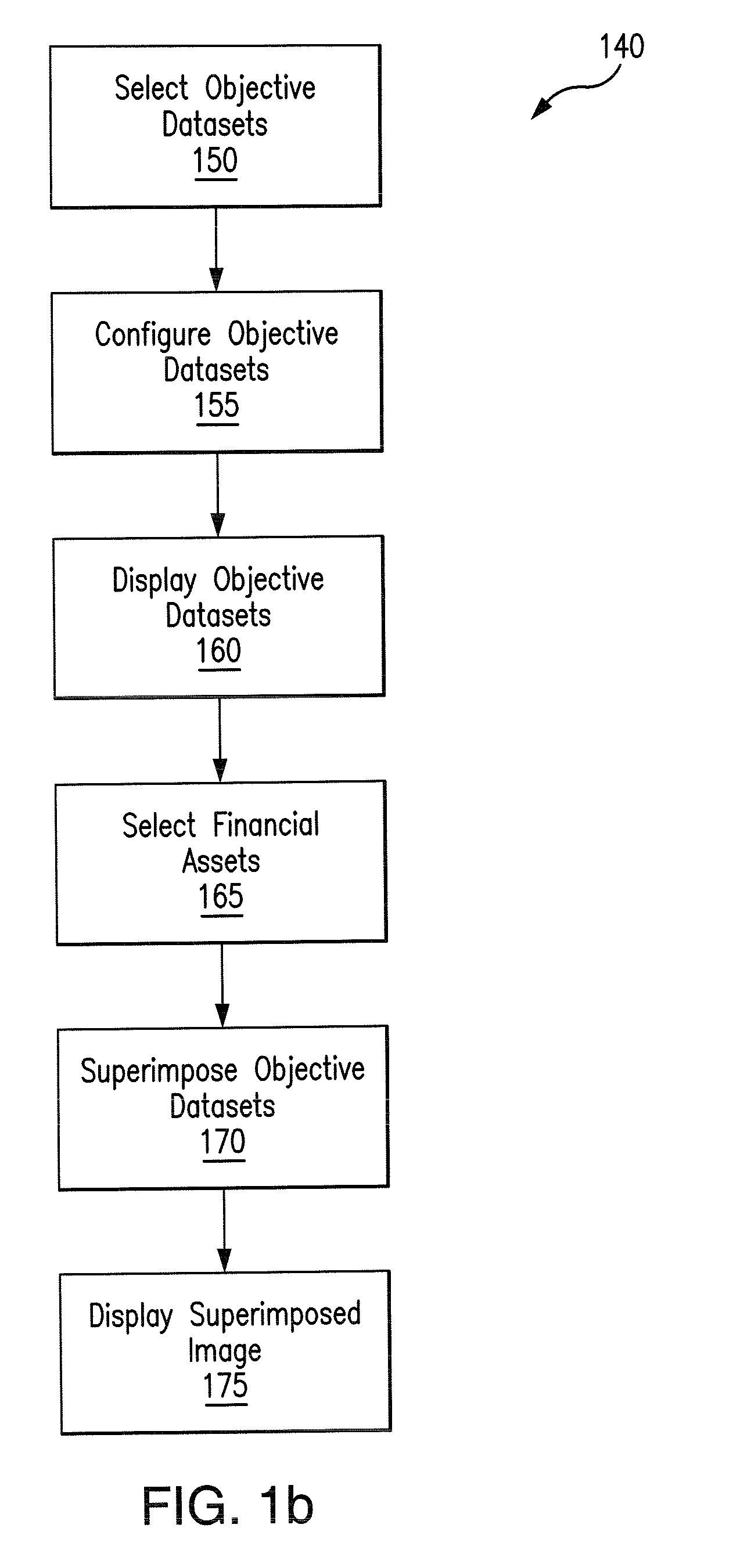

Method and Data Processing System for Financial Planning

A computer-implemented method and system for producing a graphic image representative of a certain geographic region indicating certain datasets. The method including selecting at least one objective dataset correlating to the certain geographic region and segmenting the selected at least one objective dataset into a plurality of interval ranges based upon prescribed values. At least one financial dataset is selected representing financial assets relating to the certain geographic region. A graphic image is generated of the certain geographic region indicating the selected objective dataset in accordance with the segmentation of the objective dataset into a plurality of interval ranges with the at least one financial dataset being superimposed on the objective dataset wherein risk exposure of the financial dataset to the certain geographic regions is graphically illustrated on the generated graphic image.

Owner:LUMESIS

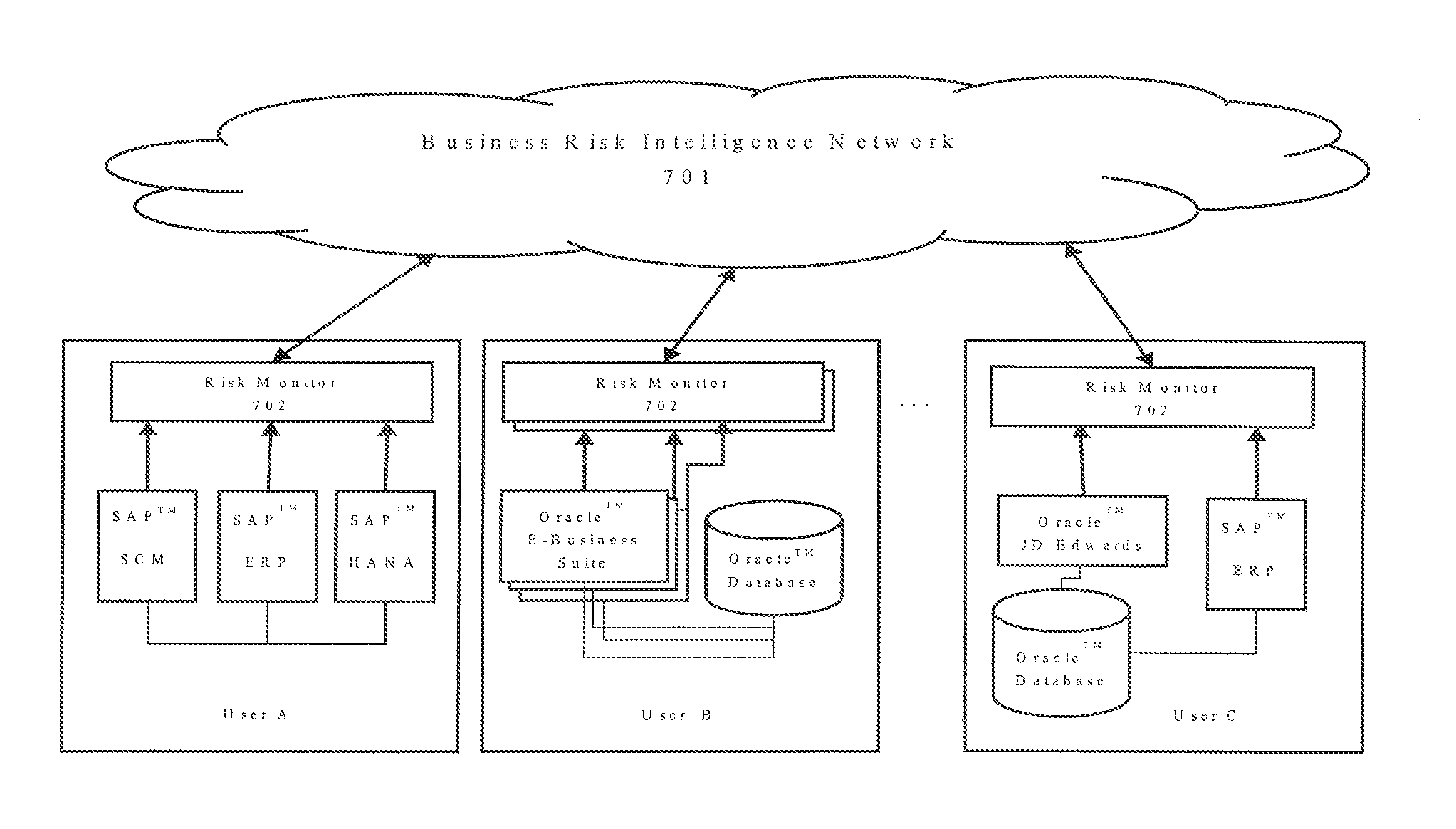

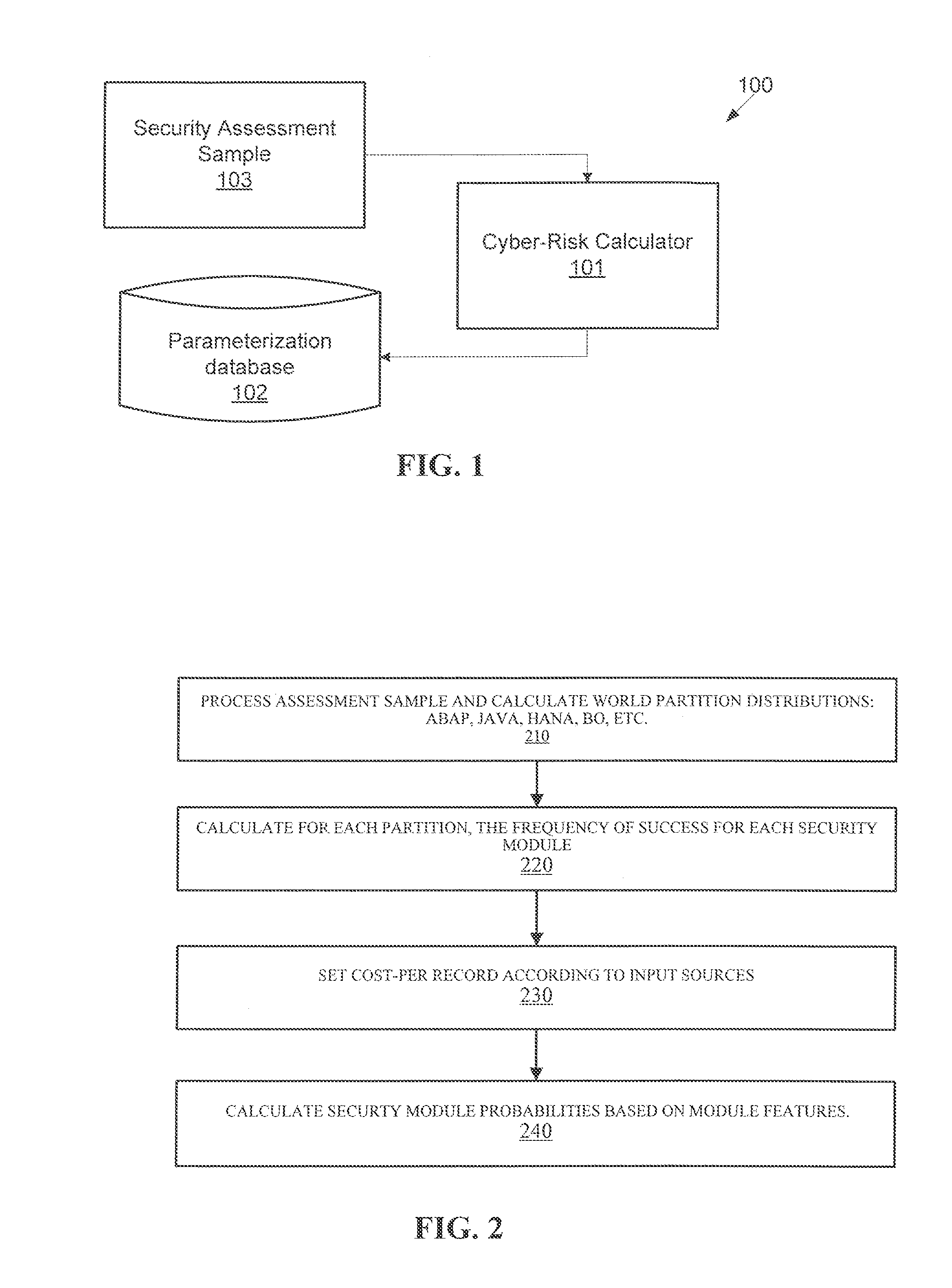

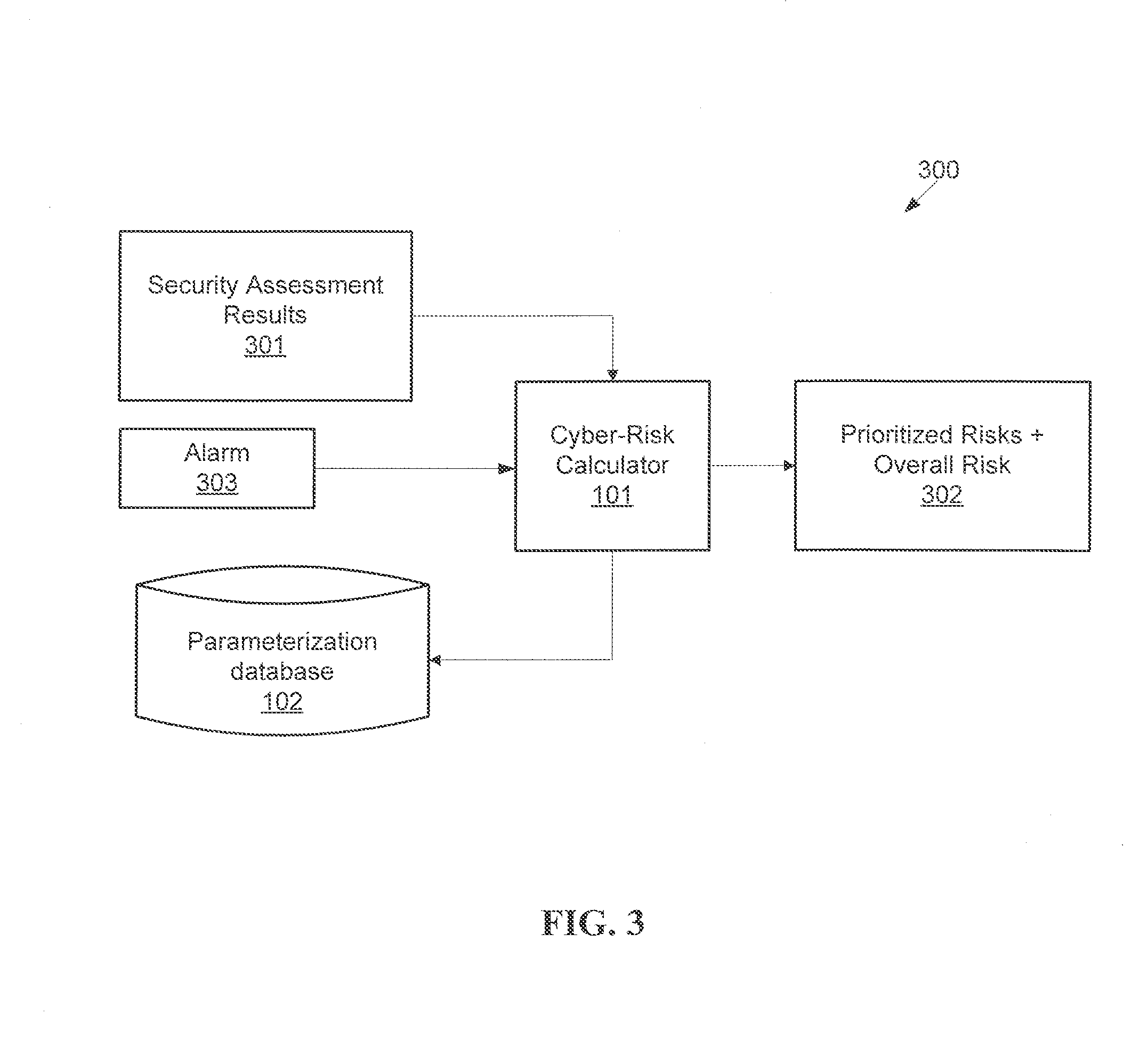

System and method for automatic calculation of cyber-risk in business-critical applications

ActiveUS20160119373A1Automatically calculateWeb data indexingMemory loss protectionRisk exposureComputer science

A system for calculating cyber-risk in a software application includes a cyber-risk calculator. The cyber-risk calculator receives a security assessment result sample having a list of security modules, each security module listing including a respective result of a security assessment of the application identifying a vulnerability and / or misconfiguration capable of being exploited and / or abused. When run in a risk calculation mode, the cyber-risk calculator determines a world partition of the application in the security assessment result sample belongs to, references a set of parameters from a parametrization database according to the world partition corresponding to the application, determines a cyber-risk exposure level for the application based upon the security assessment result sample and the set of parameters, and reports results of the cyber-risk calculation.

Owner:ONAPSIS

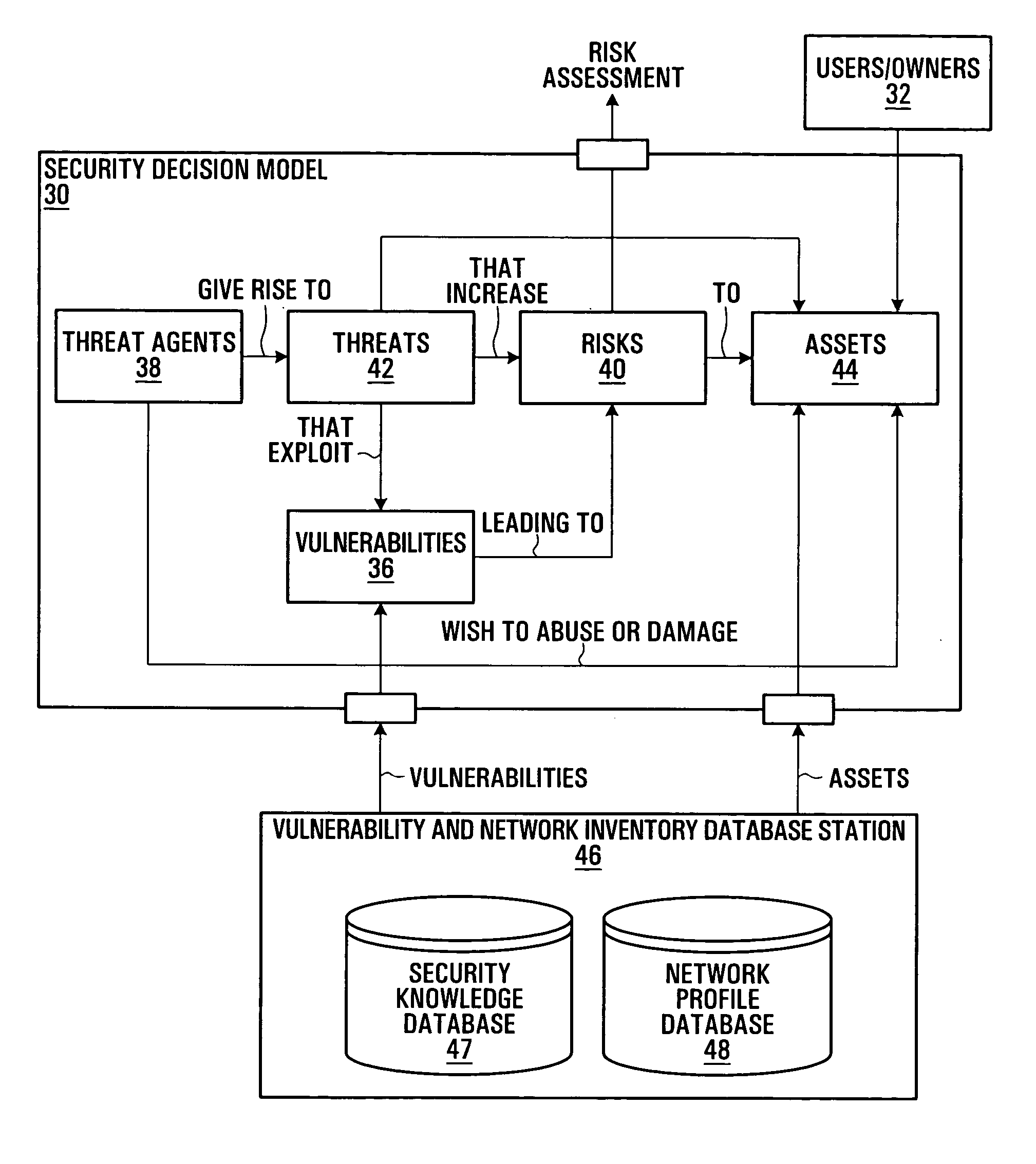

Communication network security risk exposure management systems and methods

ActiveUS7743421B2Memory loss protectionUnauthorized memory use protectionRisk exposureComputer science

Communication network security risk exposure management systems and methods are disclosed. Risks to a communication network are determined by analyzing assets of the communication network and vulnerabilities affecting the assets. Assets may include physical assets such as equipment or logical assets such as software or data. Risk analysis may be adapted to assess risks to a particular feature of a communication network by analyzing assets of the communication network which are associated with that feature and one or more of vulnerabilities which affect the feature and vulnerabilities which affect the assets associated with the feature. A feature may be an asset itself or a function or service offered in the network and supported by particular assets, for example.

Owner:HUAWEI TECH CO LTD

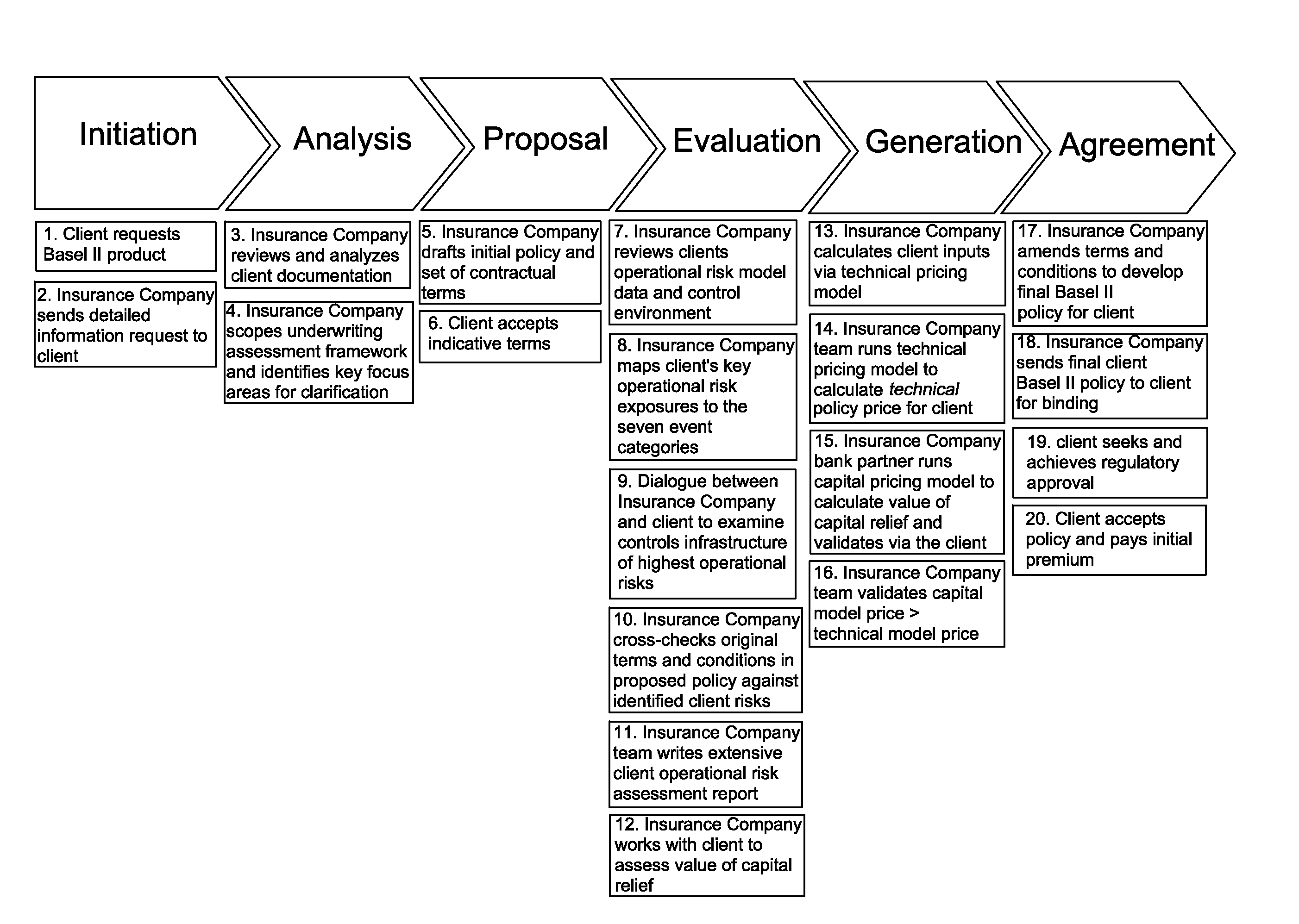

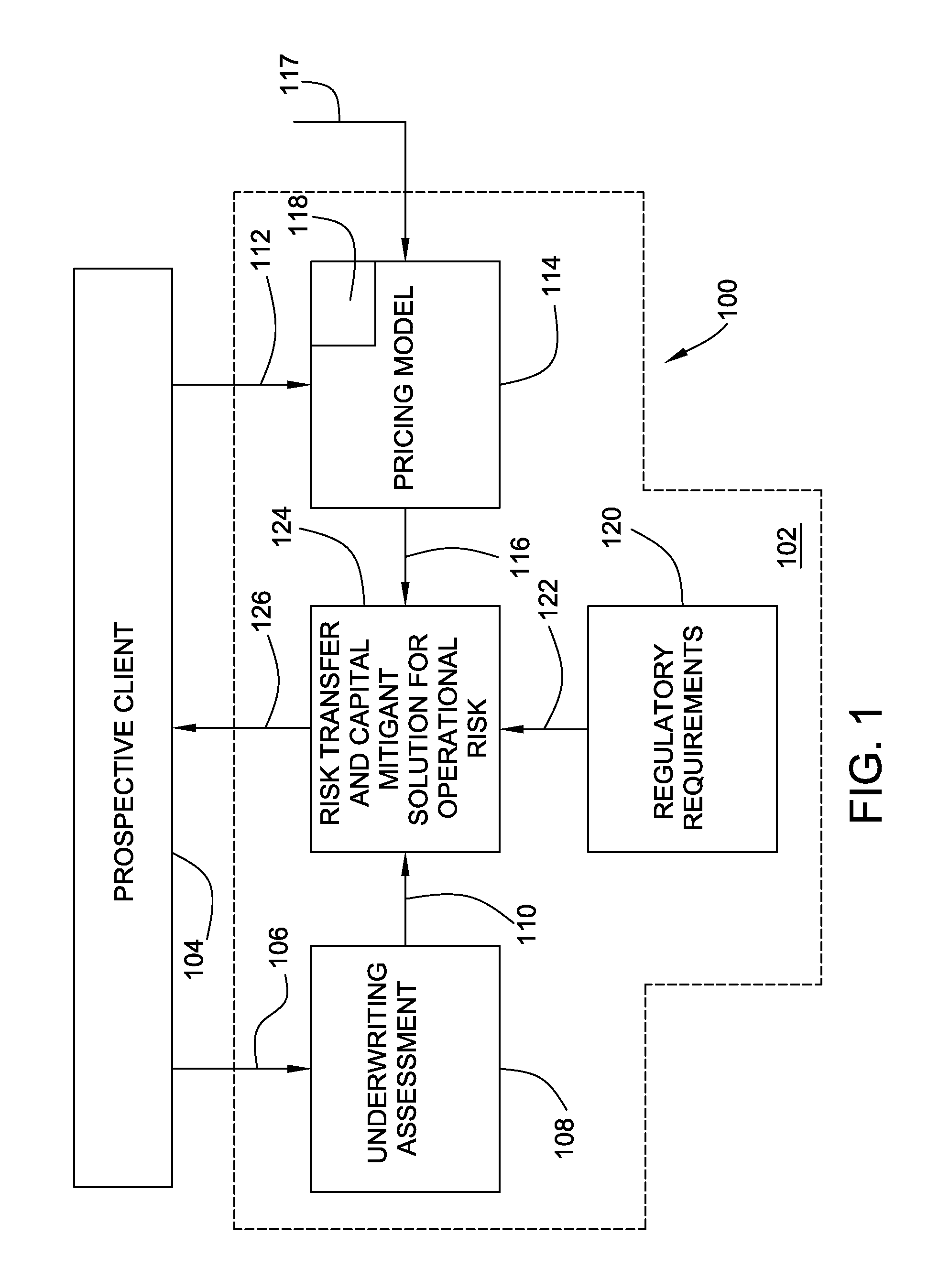

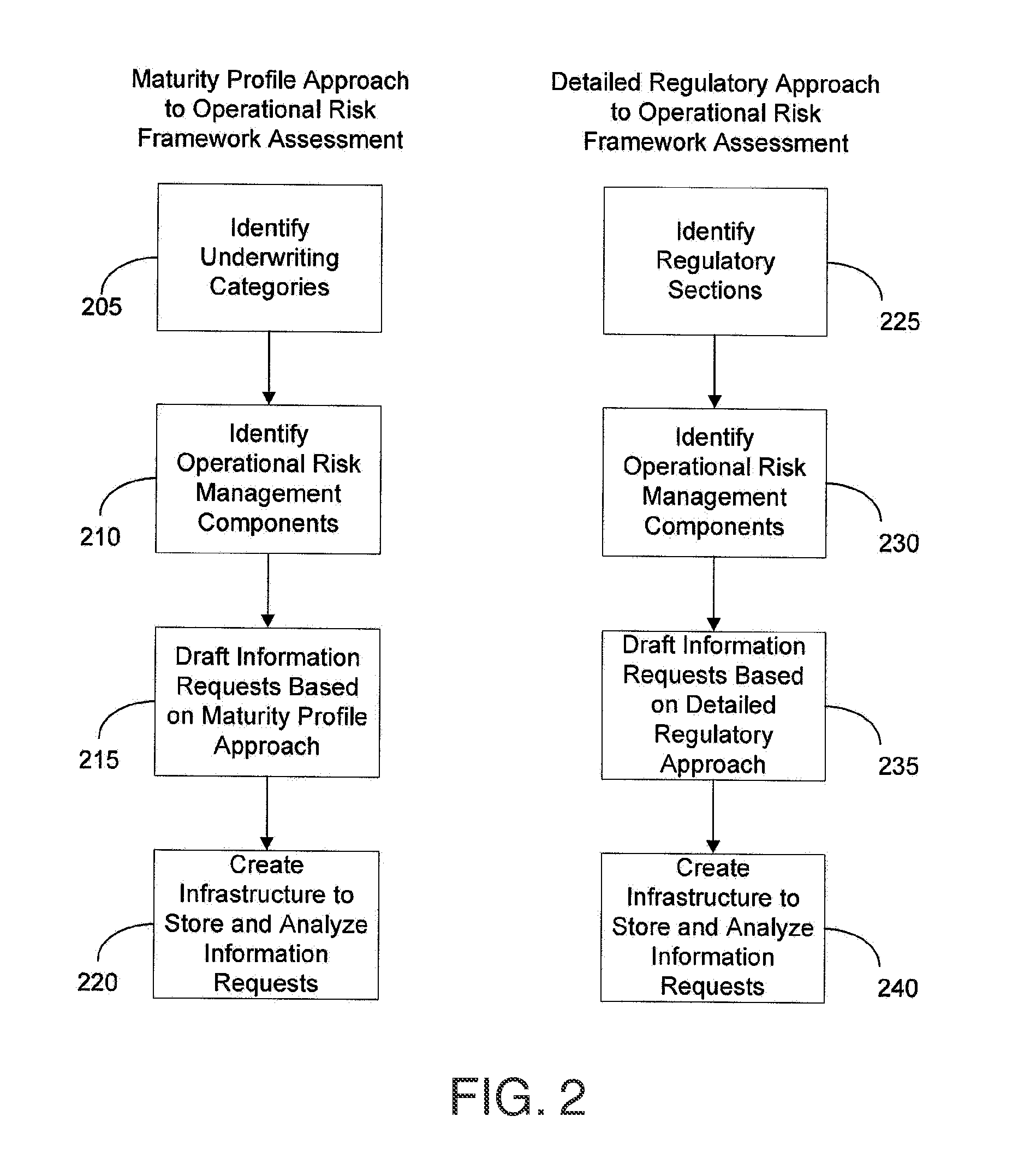

Method and system of insuring risk

Owner:AMERICAL INTERNATIONAL GROUP INC

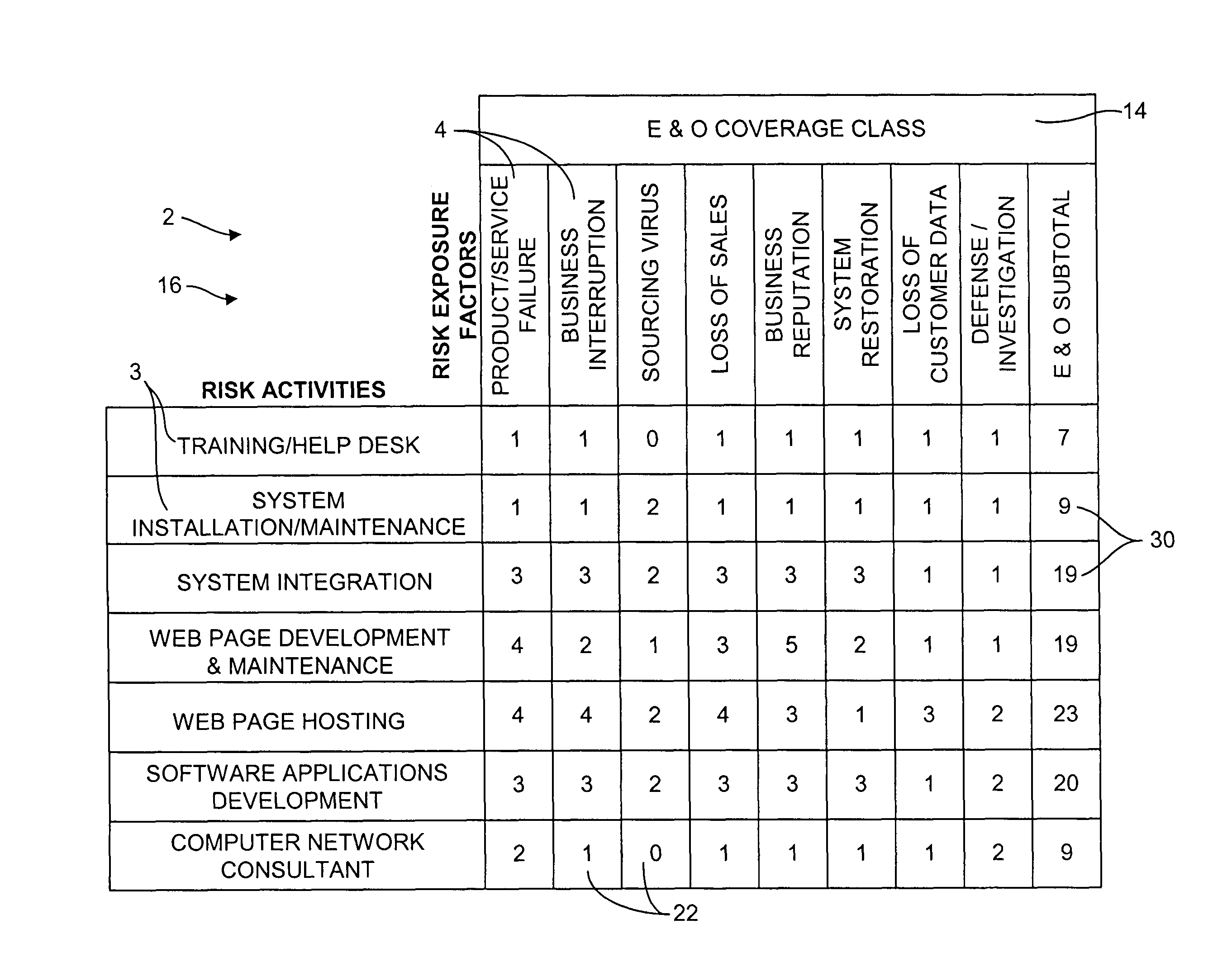

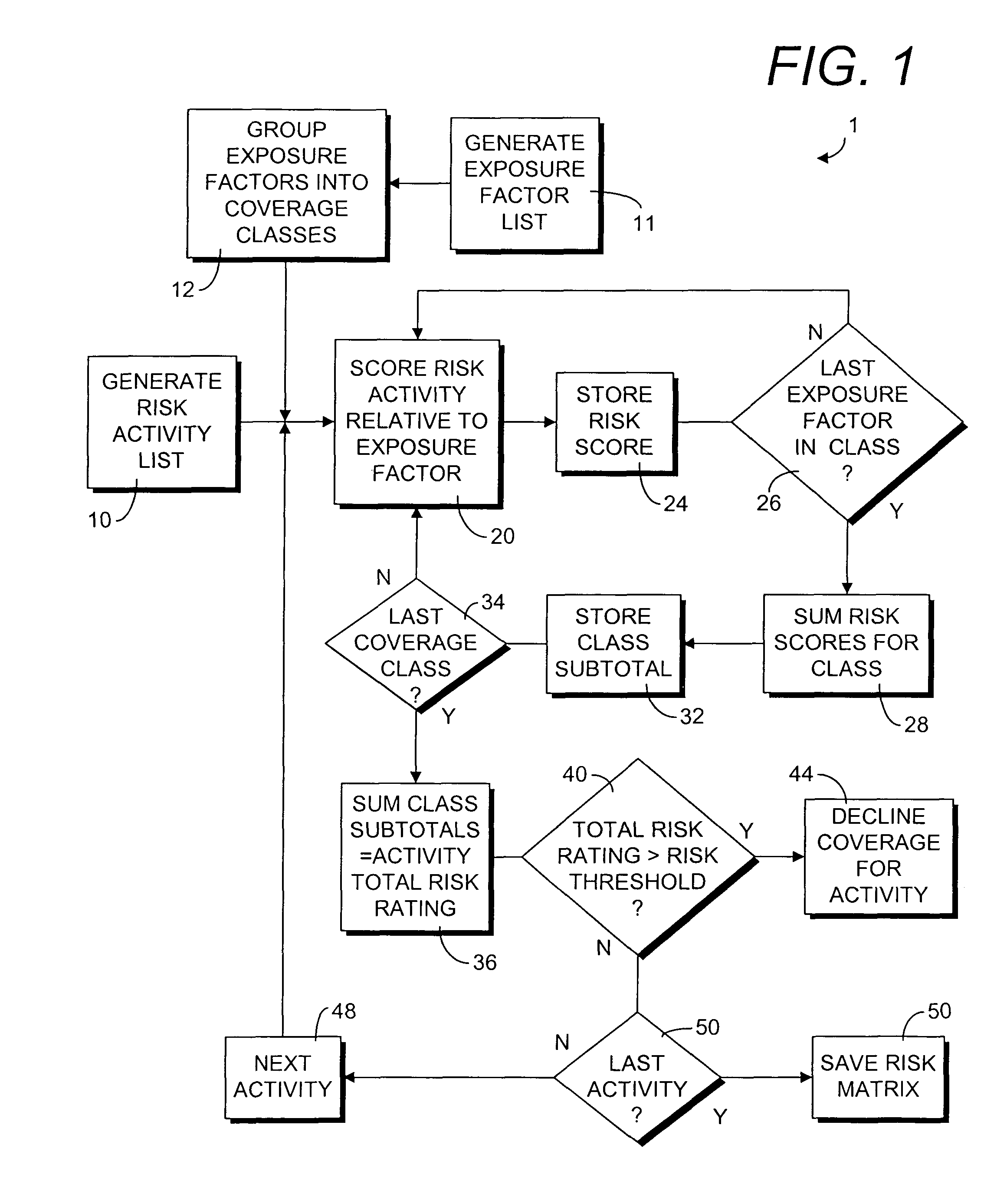

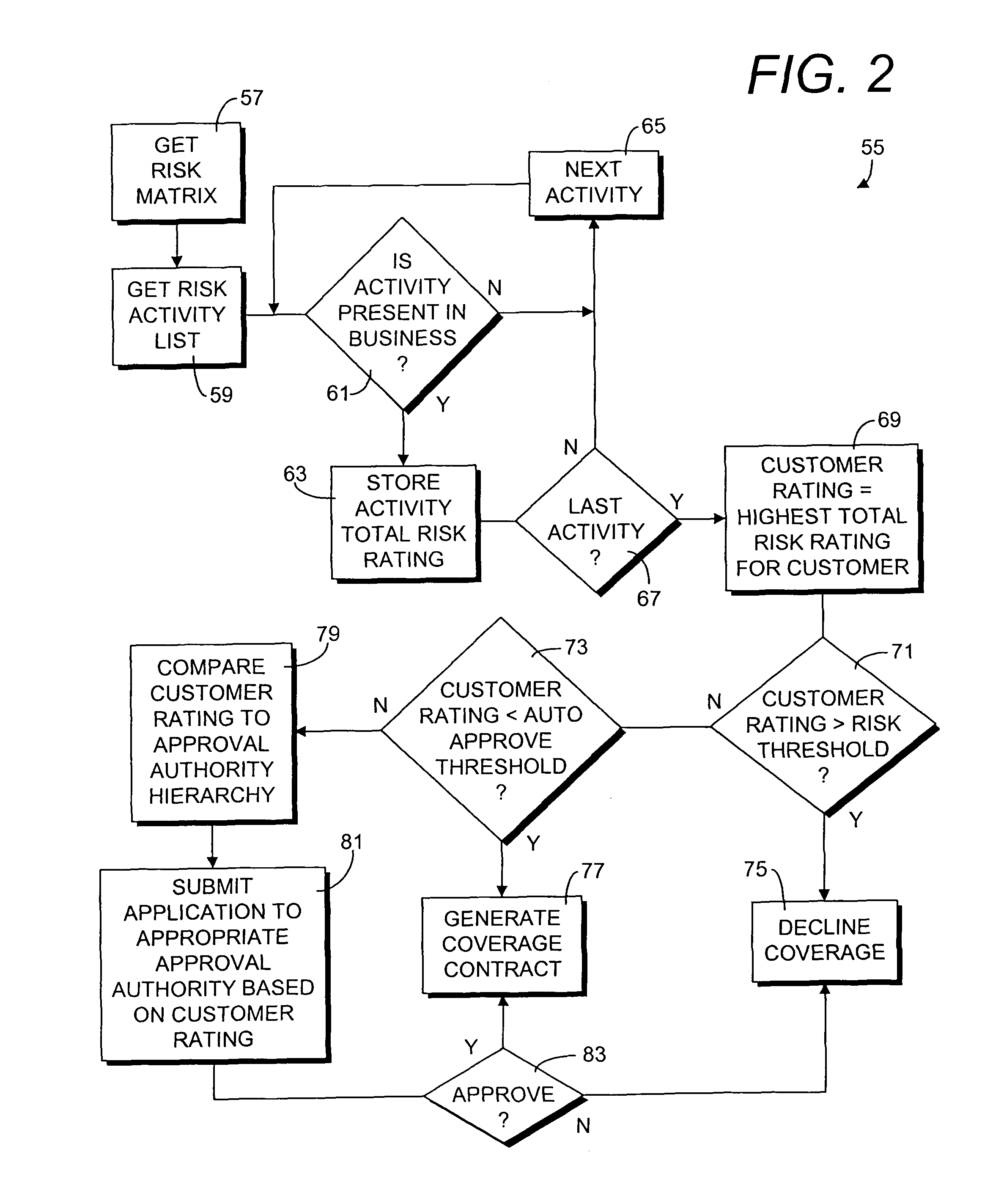

Risk assessment method

InactiveUS8515783B1Cheap and practicalAccurate and efficient in practiceFinanceRisk exposureTotal risk

A risk assessment method for insurance coverage of an enterprise includes identifying component risk activities of the enterprise, identifying the risk exposure factors which may be applicable to such activities, numerically scoring each activity against each risk exposure factor on the frequency and severity of potential claims on the exposure factor for the activity in a risk matrix, summing all the scores for each activity to obtain a corresponding total risk rating, and analyzing each total risk rating against hierarchies of approval authority to bind coverage on the activity and the potential premium rate for the activity. The method includes identifying a highest total risk rating an applicant as a customer rating which is used as an overall measure of potential risk exposure for the applicant. The method includes the capability of automatically declining, approving, or renewing coverage based on the customer rating.

Owner:SWISS REINSURANCE CO LTD

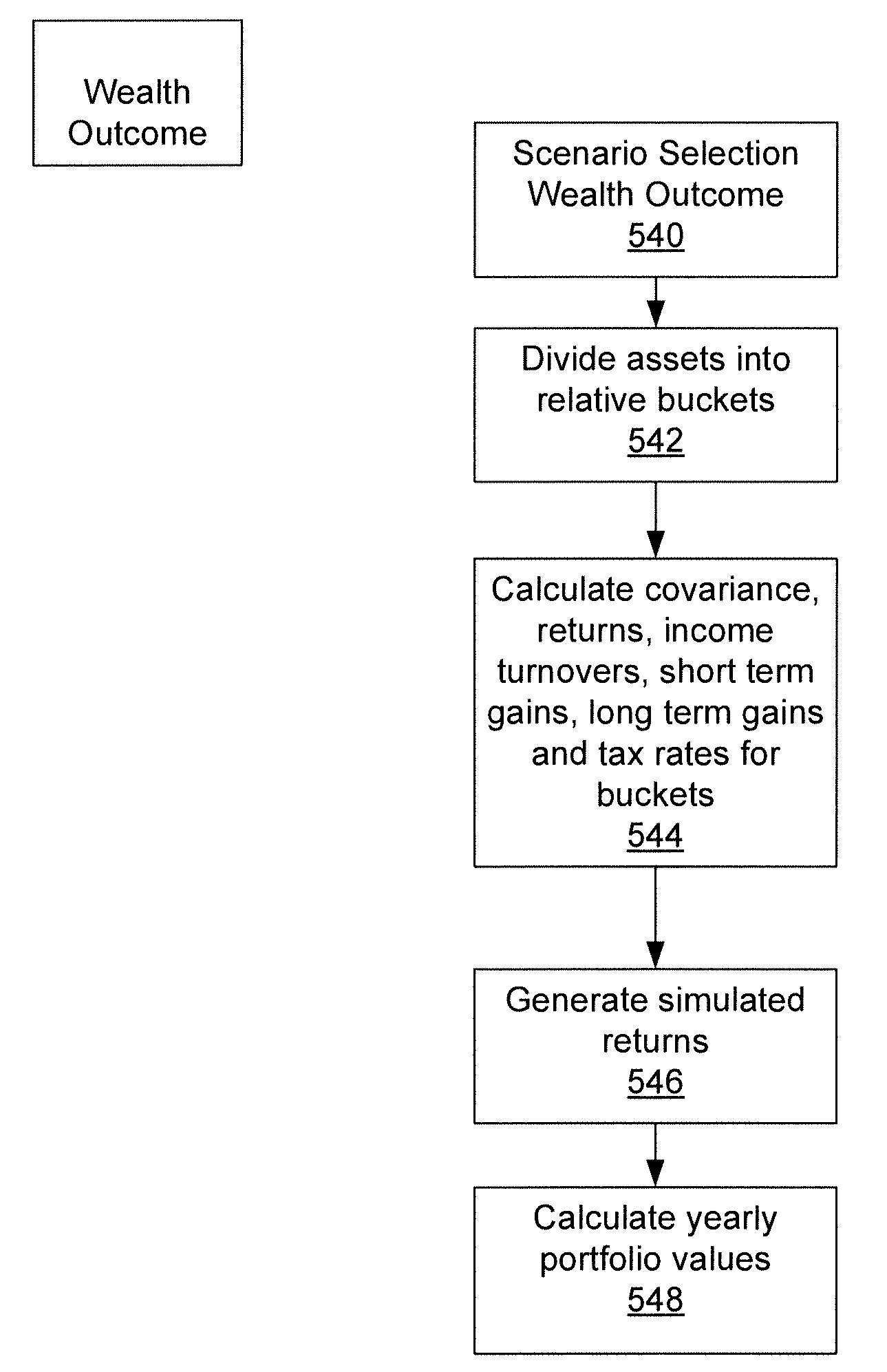

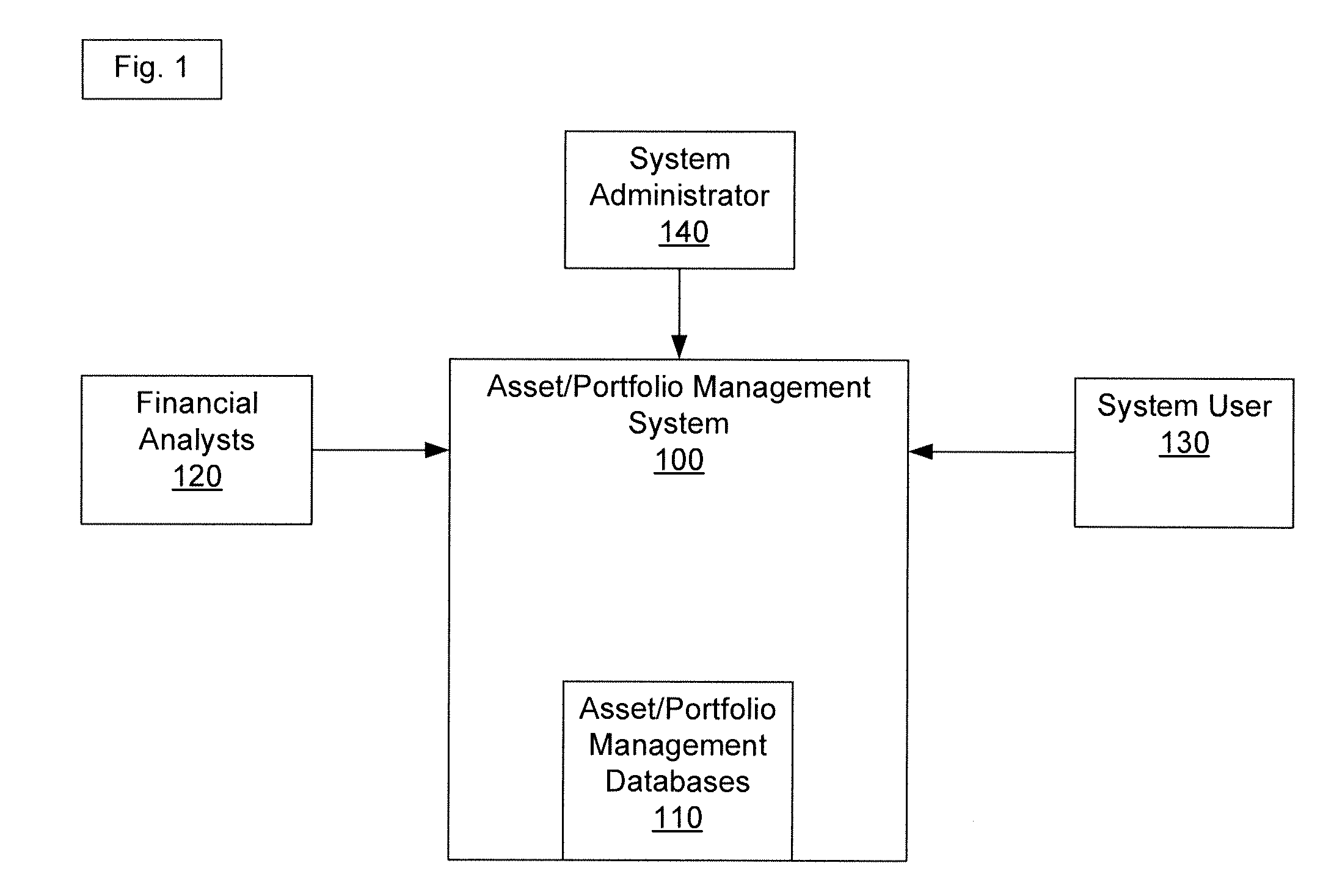

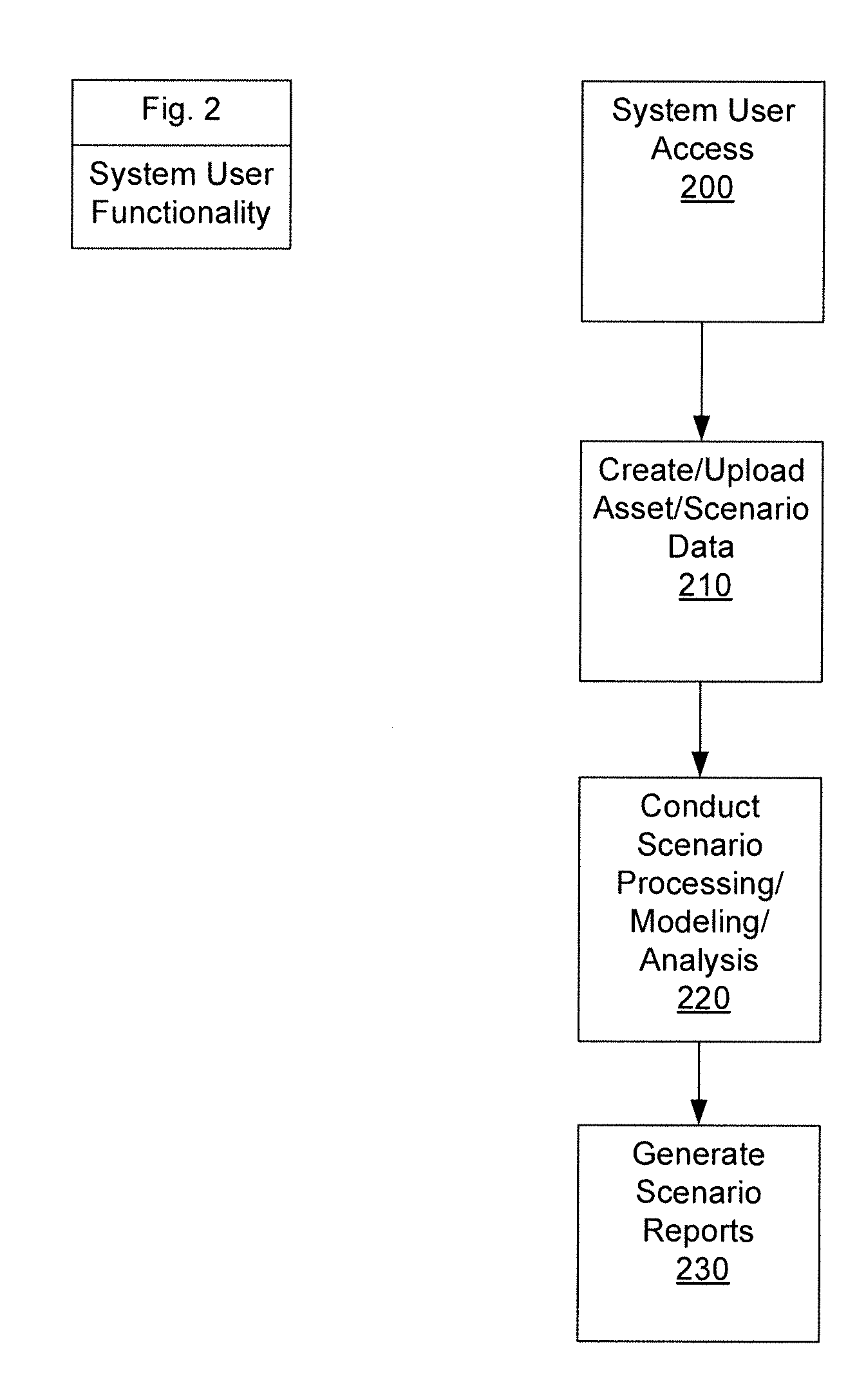

Method, system and apparatus for wealth management

The invention enables a system user to create a scenario that includes an analysis resolution, portfolio component data and analysis environment data. Once the scenarios are established, the system user can conduct processing / modeling / analysis in order to optimize the portfolio allocation data—effectively maximizing the return on the component investments, while minimizing the risk exposure for the portfolio. In achieving the optimization, the system can process stored user or system defined scenarios based on a series of modeling / analysis system modules. Further, it is possible for a system user to model, analyze and compare multiple scenarios historically or prospectively. The system may provide wealth outcome analysis which allows a user to determine likely long term outcomes of a particular investment plan, while accounting for the tax consequences of the chosen plan. In an implementation, the system is configured to store the modeling / analysis results and generate a scenario report. Further, the system can be configured to generate the report in a standardized format and automatically distribute the report to designated recipients.

Owner:GOLDMAN SACHS & CO LLC

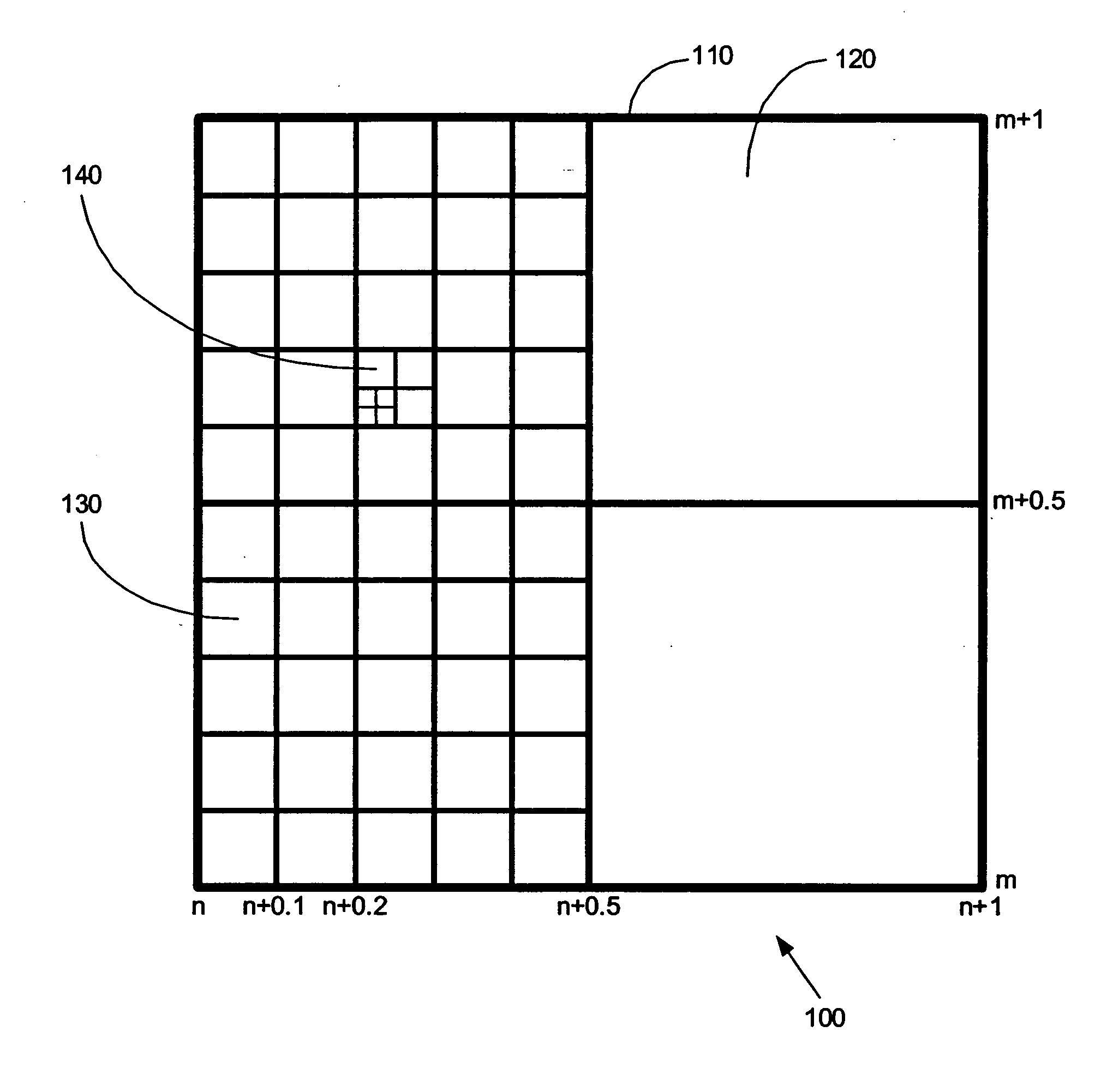

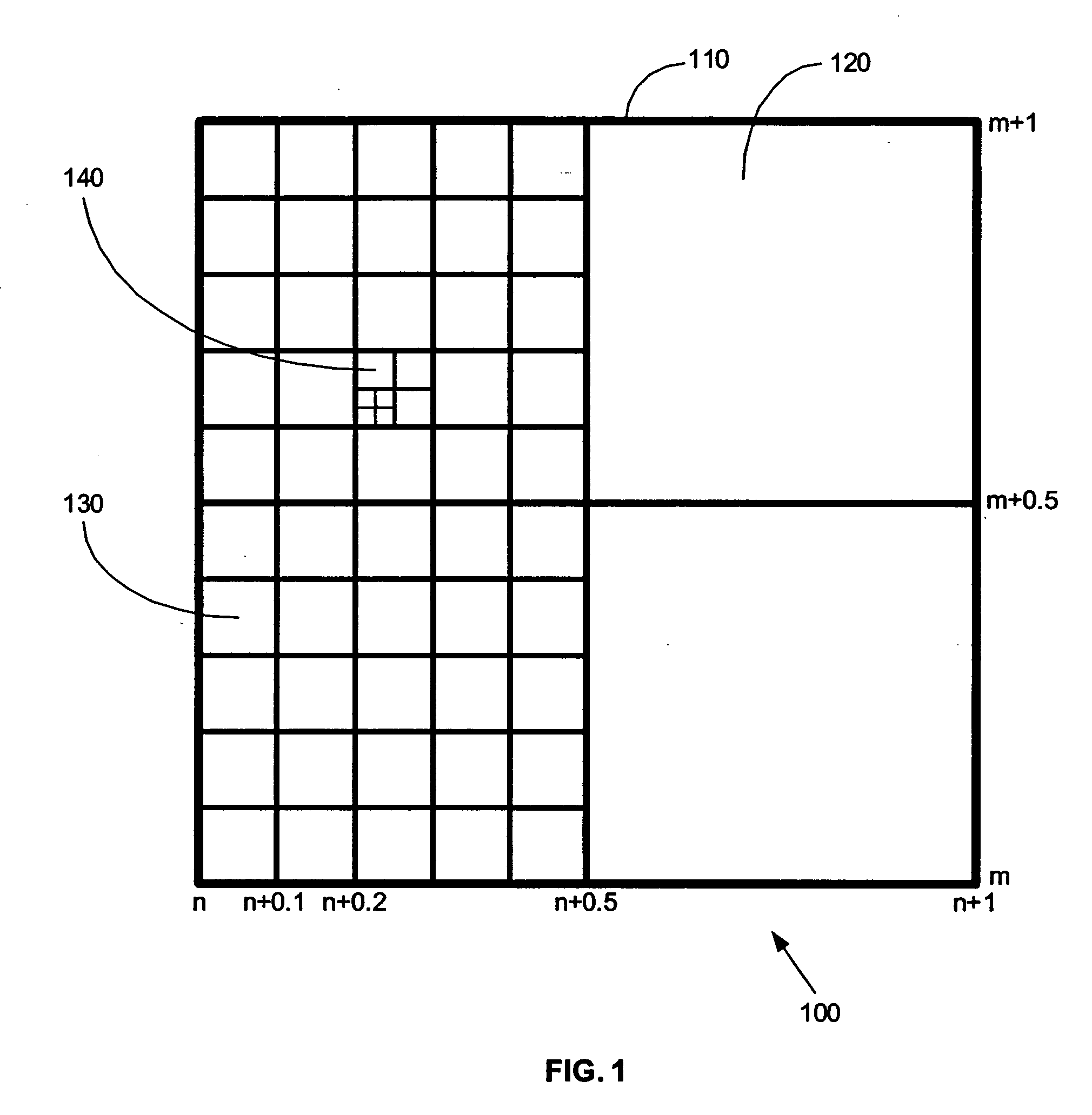

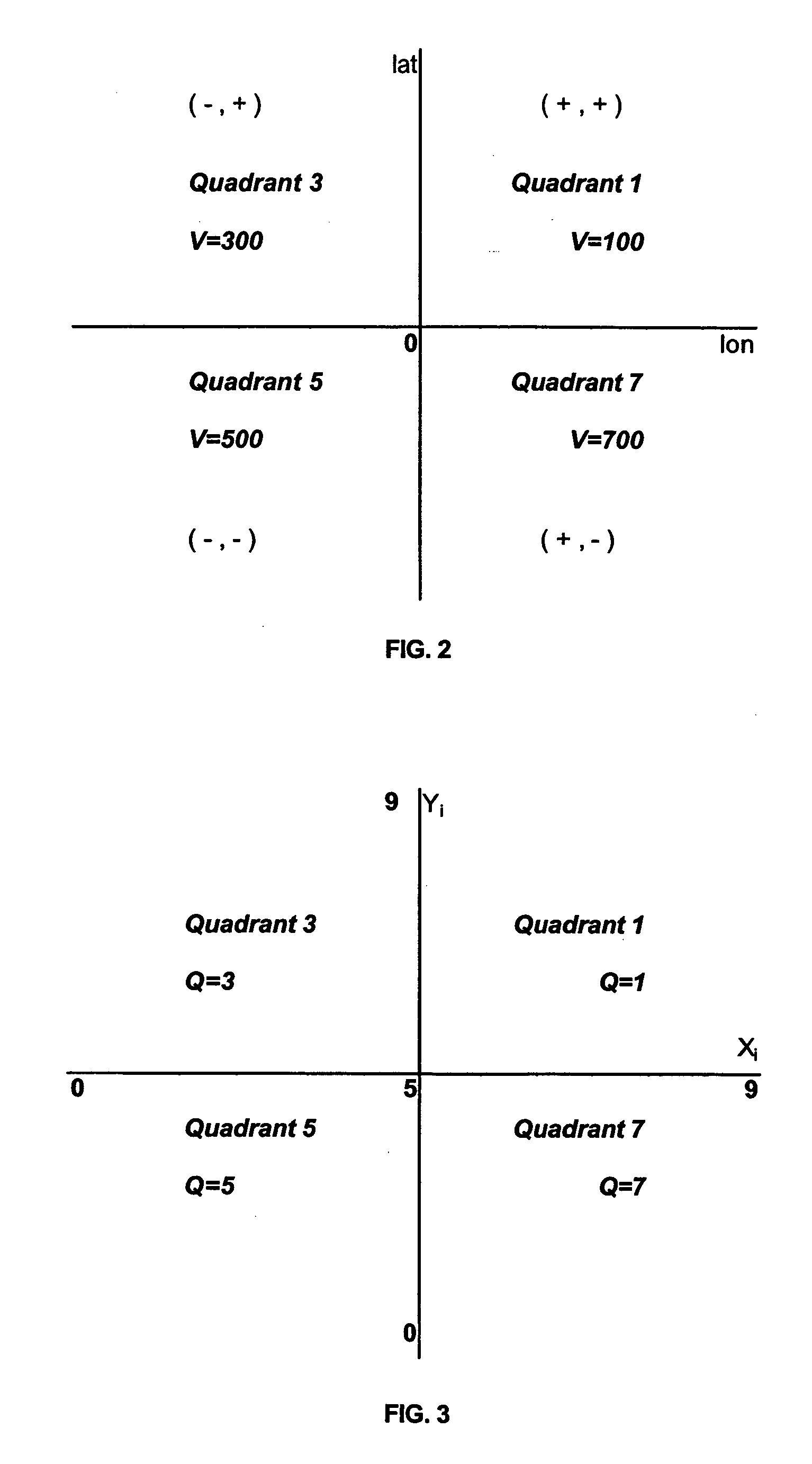

System and method for producing a flexible geographical grid

ActiveUS20070118291A1Efficient data storageReduce resolutionFinanceDigital data processing detailsRisk exposureImage resolution

A variable resolution grid provides a mechanism for focusing specific concentrations of risk exposure on a geographical grid to determine projected loss caused by a particular catastrophe. The geographic grid provides a stable base map by using latitudes and longitudes to define the grid points and cells. Each cell is assigned a geographic identifier or geocode that identifies the location of the cell and its associated resolution. The resolution of the grid may be varied depending in part, on the resolution of any available of hazard data.

Owner:RISK MANAGEMENT SOLUTIONS

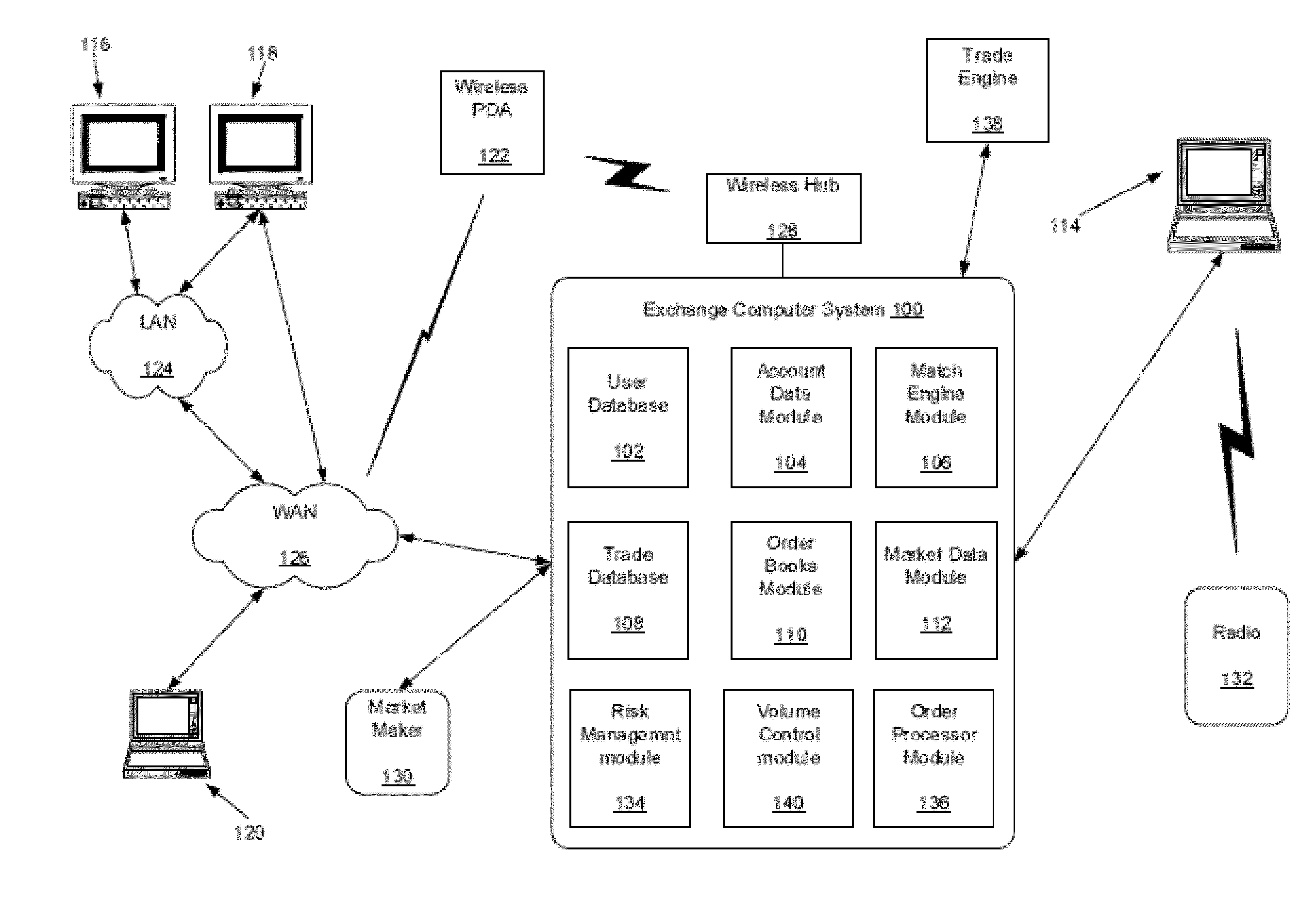

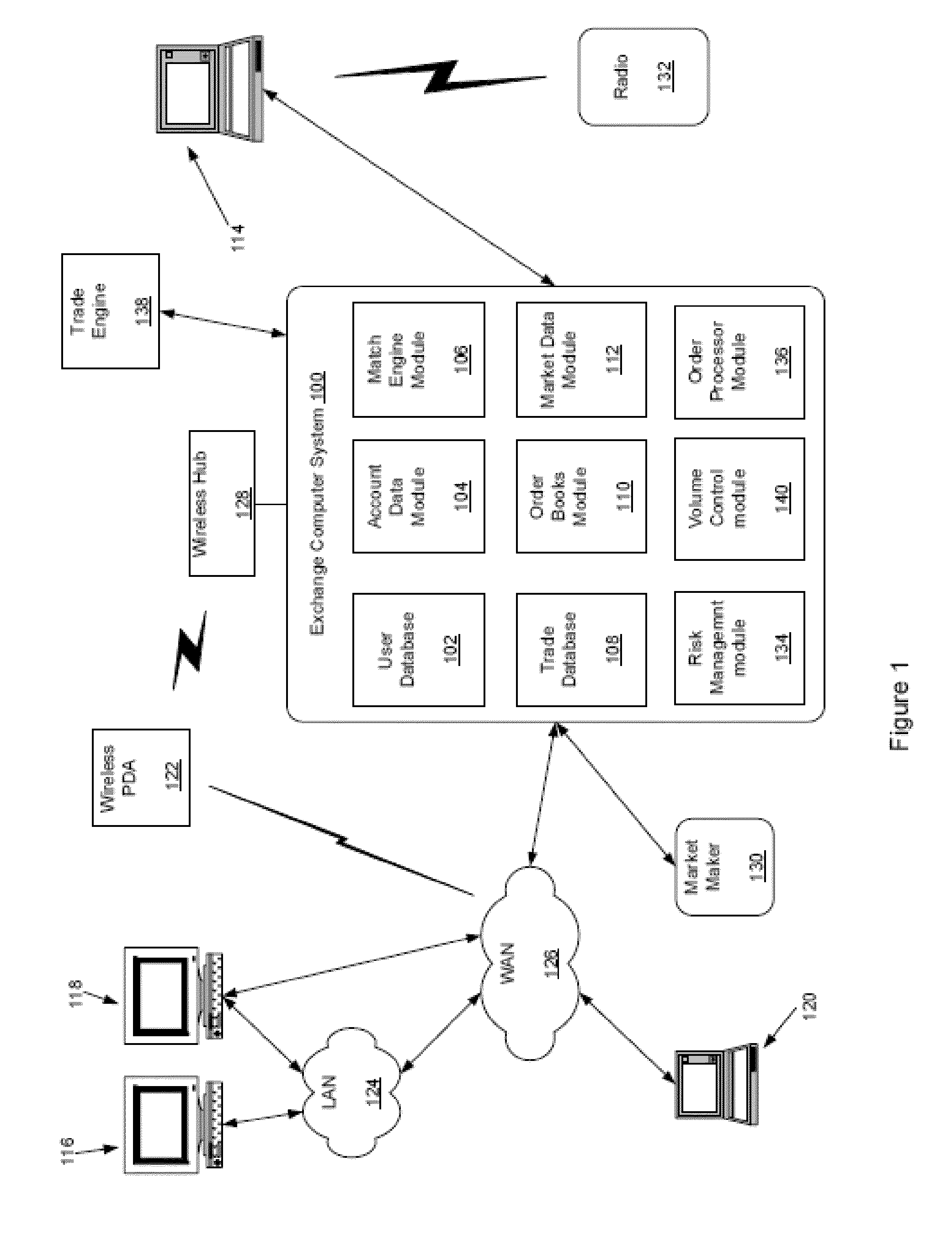

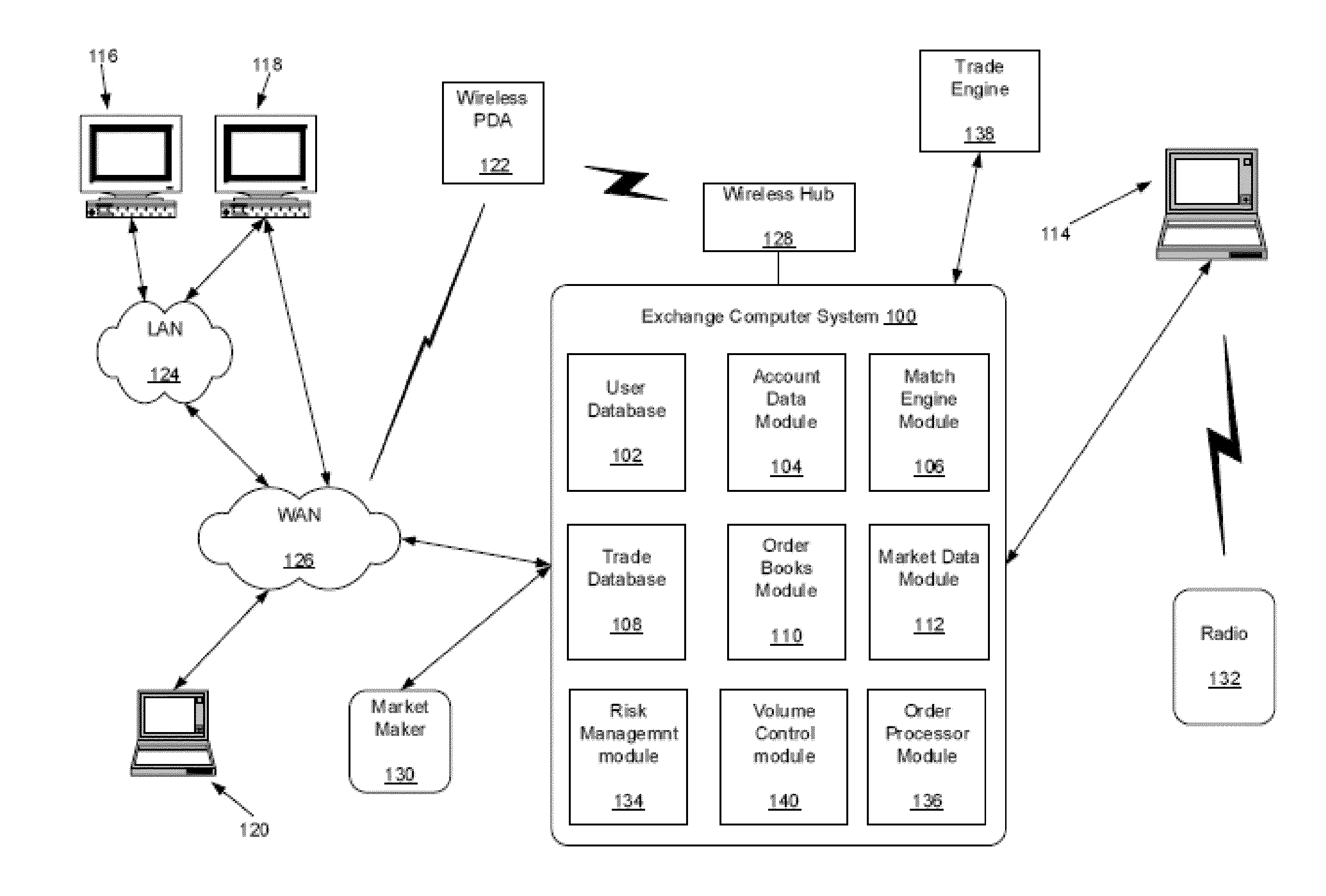

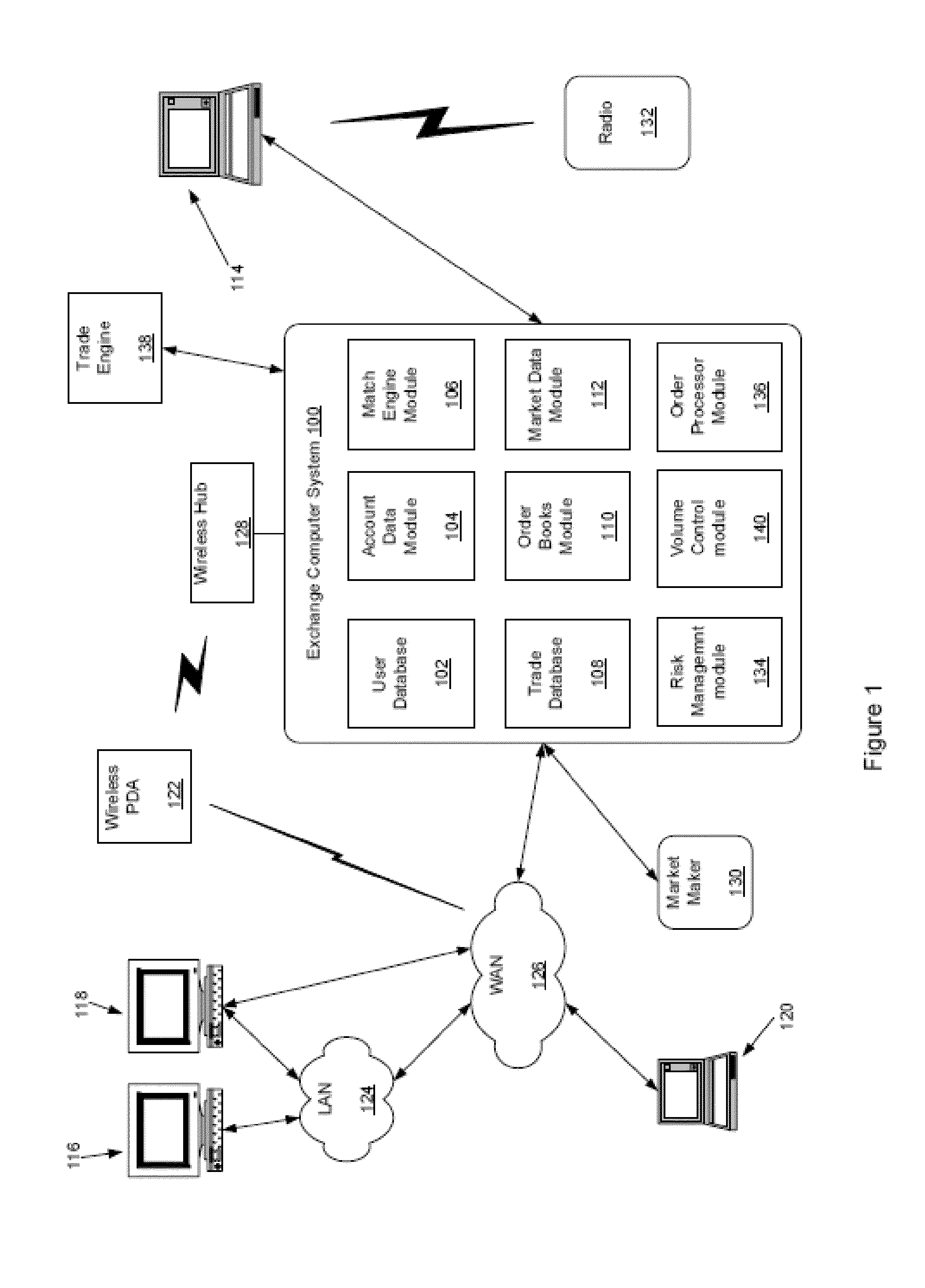

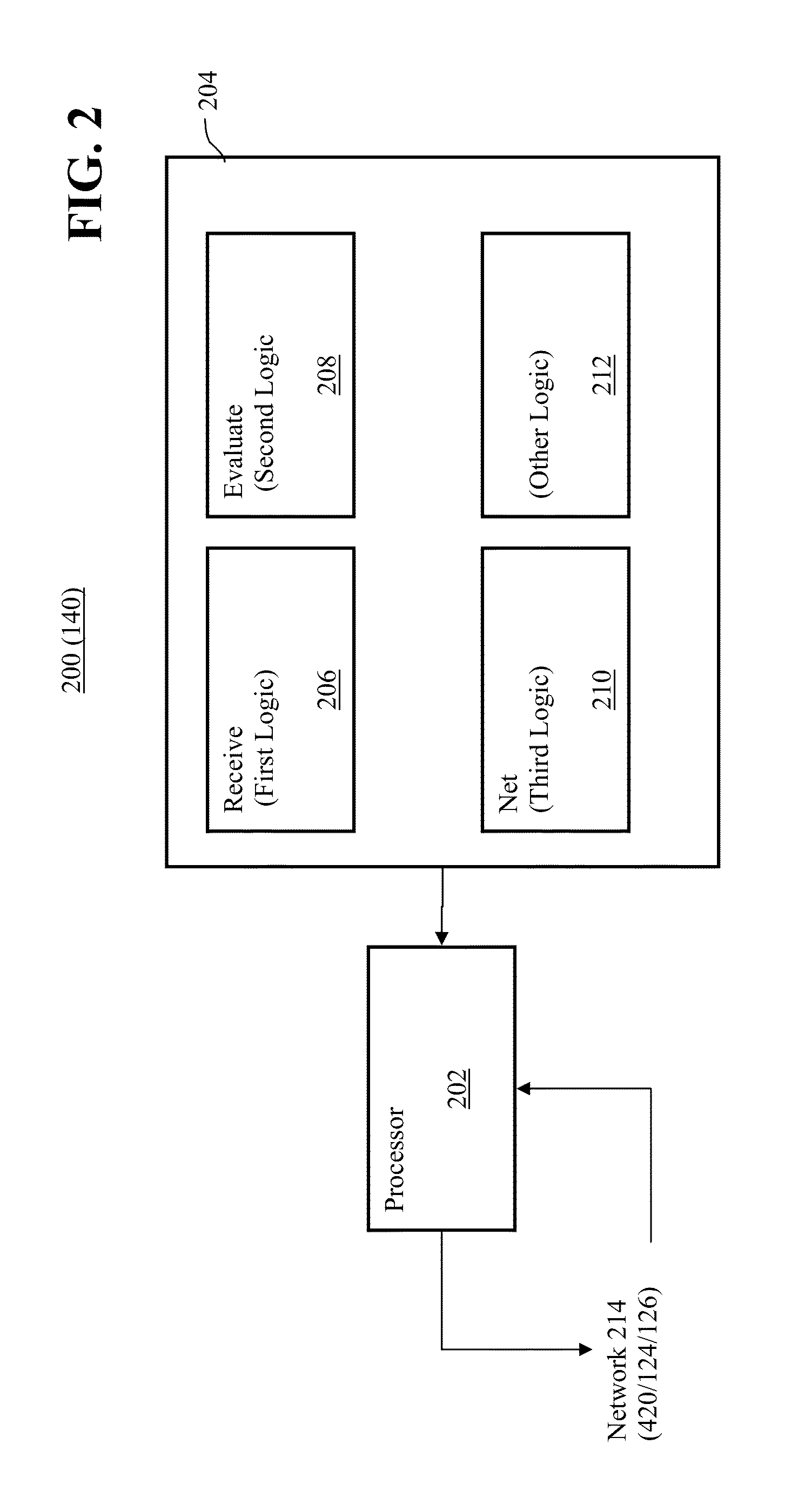

Interest Rate Swap Compression Match Engine

The disclosed embodiments relate to a system for trading using a central counterparty which allows market participants to minimize risk and / or transactional fees associated with a portfolio of bilateral positions without substantially altering a risk profile thereof. In particular, the disclosed embodiments allow a market participant holding a portfolio of heterogeneous bilateral positions, such as positions in interest rate swap (“IRS”) contracts, to net together similar but not identical positions within their portfolio, thereby reducing margin requirements and / or transaction fees, according to criteria specified by the market participant, and which may be different from criteria specified by other market participants, wherein the overall risk exposure desired by the market participant in entering into the positions remains substantially unchanged as does the desired overall risk exposure of the counterparty market participants to those positions.

Owner:CHICAGO MERCANTILE EXCHANGE INC

Risk-based reference pool capital reducing systems and methods

Embodiments consistent with the present invention provide a credit enhancement structure for risk allocation between parties that minimizes the regulatory capital reserve requirement impact to an institution subject to capital reserve requirement. A subject pool of assets held by the institution, such as a pool of loans, is rated to determine its risk levels. Based on the rated risk levels, a guarantor party agrees to be responsible for a portion of the risk associated with the pool of assets, which may define the maximum risk exposure of the institution holding the asset pool. The risk-rated capital reserve requirements are applied to the asset pool based on the risk level rating and the guarantor's agreed upon risk responsibility such that the institution holds a reduced amount of reserve capital compared to what it would otherwise be required to hold.

Owner:FREDDIE MAC

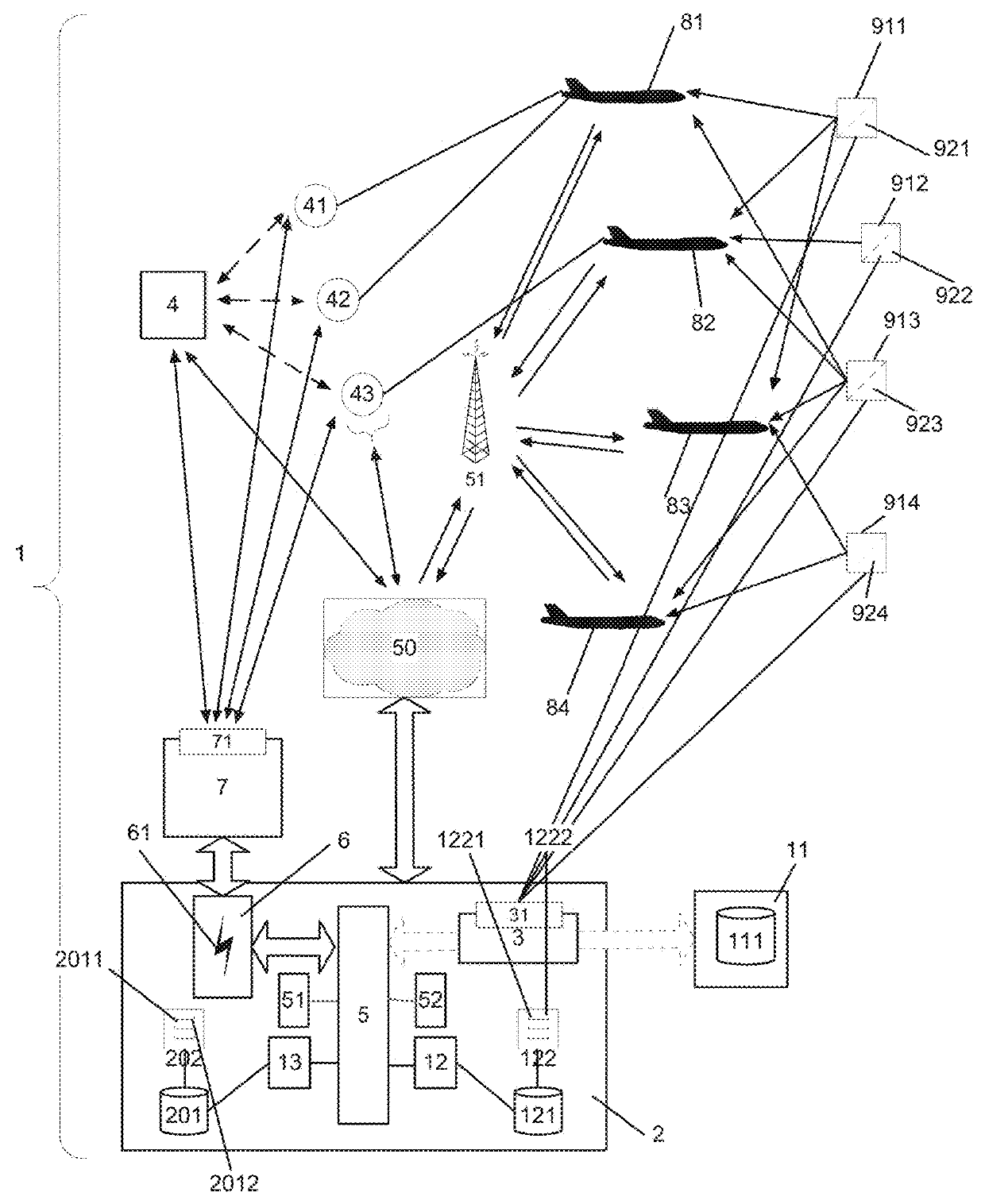

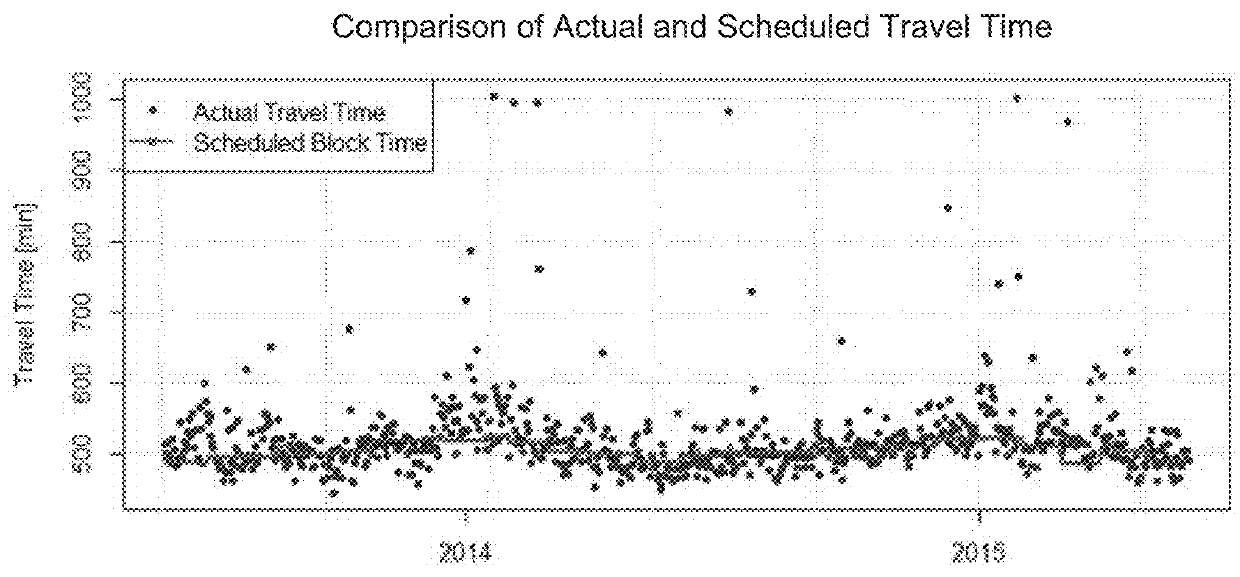

Flight trajectory prediction system and flight trajectory-borne automated delay risk transfer system and corresponding method thereof

ActiveUS20180181144A1Easy to operateImprove sustainabilityAutonomous decision making processFinanceRisk sharingRisk exposure

A method and automated flight trajectory prediction and flight trajectory-borne automated delay risk-transfer system related to airspace risks for risk sharing of a variable number of risk-exposed units by pooling resources of the risk-exposed units and by providing the risk-transfer system as a self-sufficient operatable risk-transfer system based on the pooled resources for the risk-exposed units by a resource-pooling system associated with the risk-transfer system. The risk-exposed units are connected to the risk-transfer system by a plurality of payment-transfer devices configured to receive and store payments from the risk-exposed units for the pooling of their risks and resources, and an automated transfer of risk exposure associated with the risk-exposed units is provided by the risk-transfer system.

Owner:SWISS REINSURANCE CO LTD

Interest rate swap compression match engine

The disclosed embodiments relate to a system for trading using a central counterparty which allows market participants to minimize risk and / or transactional fees associated with a portfolio of bilateral positions without substantially altering a risk profile thereof. In particular, the disclosed embodiments allow a market participant holding a portfolio of heterogeneous bilateral positions, such as positions in interest rate swap (“IRS”) contracts, to net together similar but not identical positions within their portfolio, thereby reducing margin requirements and / or transaction fees, according to criteria specified by the market participant, and which may be different from criteria specified by other market participants, wherein the overall risk exposure desired by the market participant in entering into the positions remains substantially unchanged as does the desired overall risk exposure of the counterparty market participants to those positions.

Owner:CHICAGO MERCANTILE EXCHANGE

Insurance on demand transaction management system

An intermittent risk exposure liability insurance method comprising the steps of: establishing an Internet business site enabled for communication with insurers and insureds through Internet service providers; enrolling the insureds in intermittent risk exposure liability insurance policies, the policies providing for a variable insurance premium rate depending upon an intermittent use of an insured article; logging start and completion times of each intermittent use of the insured article on the Internet business site by the insured; verifying start and completion times of use of the insured article in accordance with the logged start and completion times; and applying and billing premium insurance rates in accordance with the verified and logged start and completion times of use.

Owner:STRECH KENNETH RAY

Autonomous or partially autonomous motor vehicles with automated risk-controlled systems and corresponding method thereof

Owner:SWISS REINSURANCE CO LTD

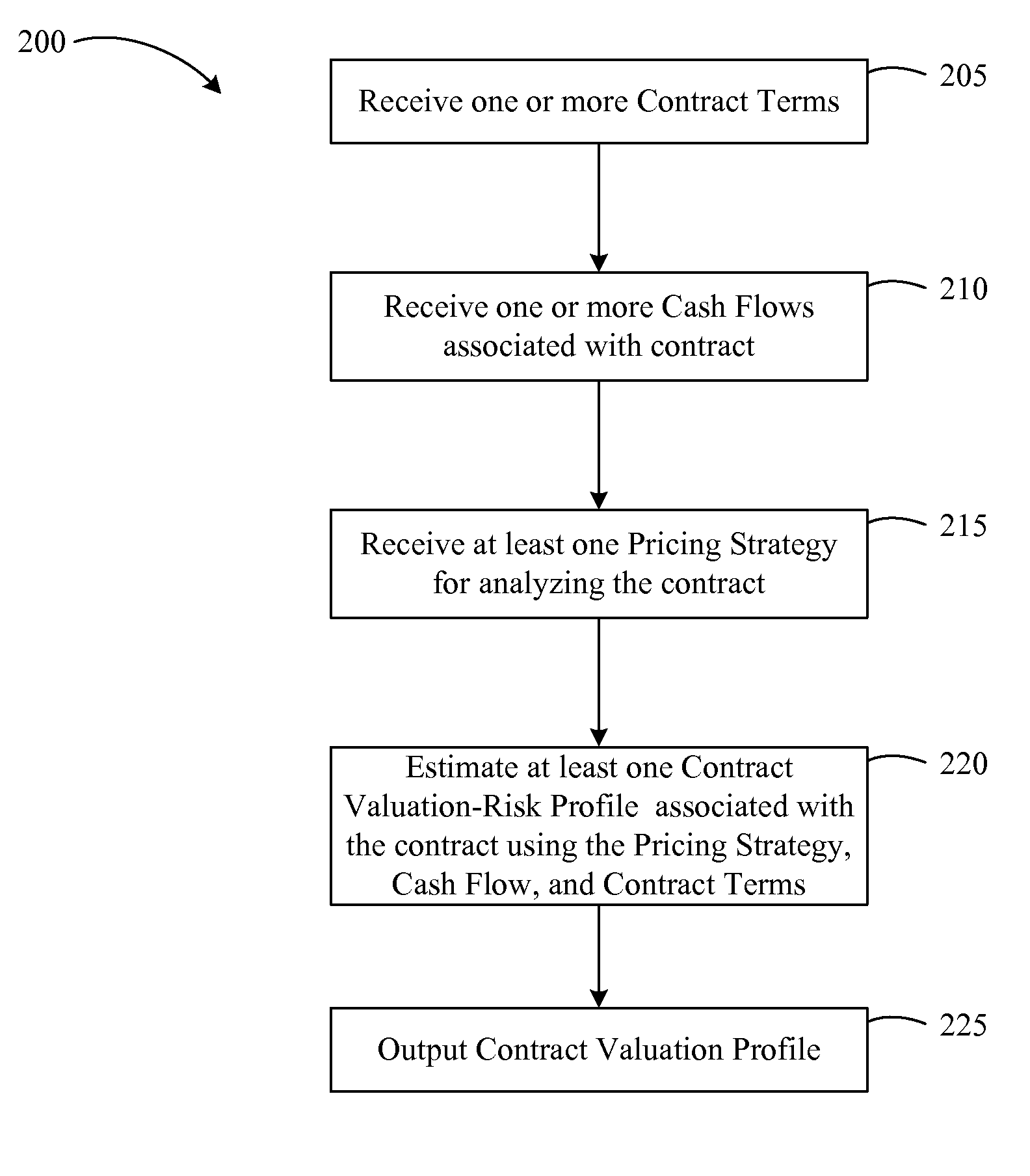

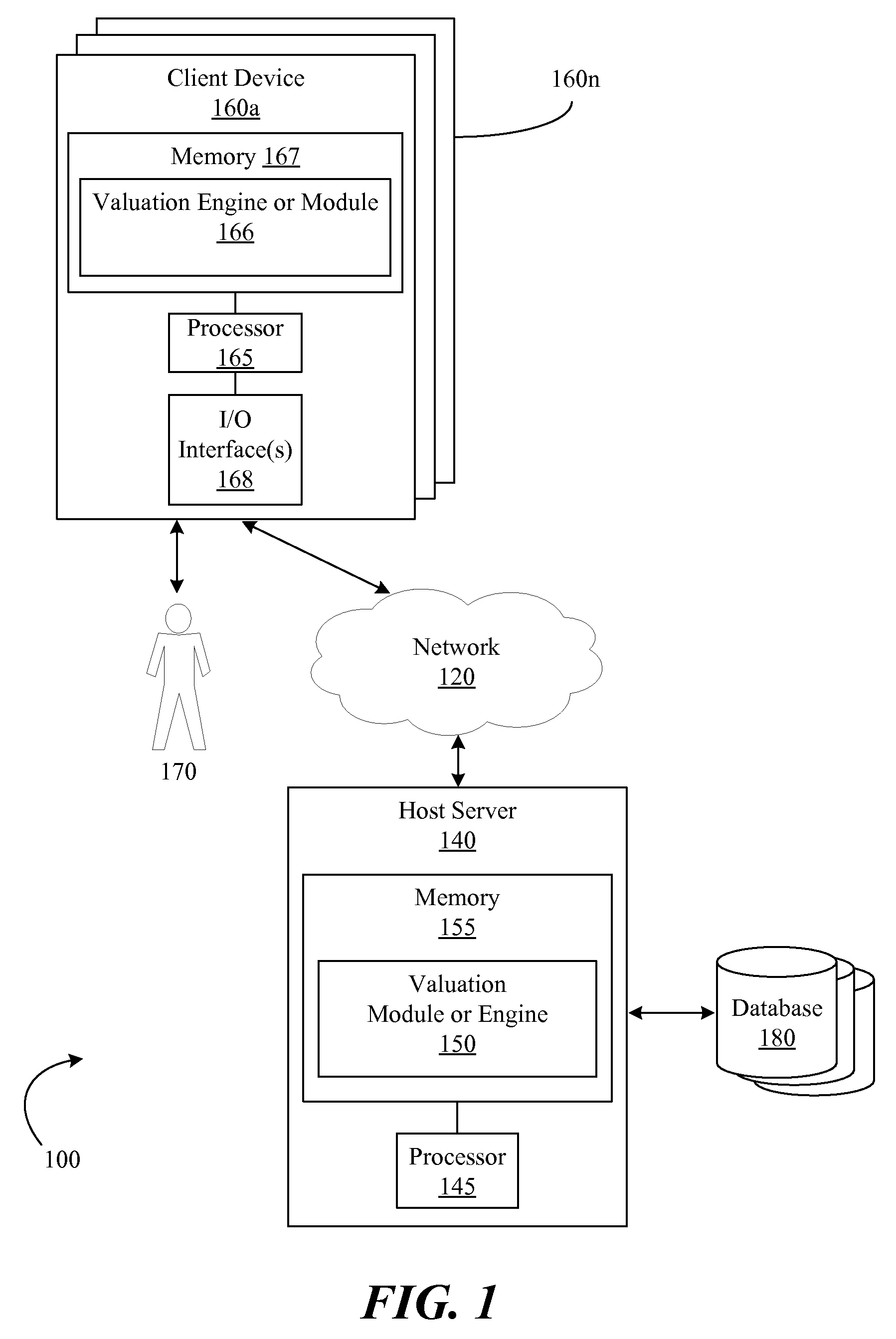

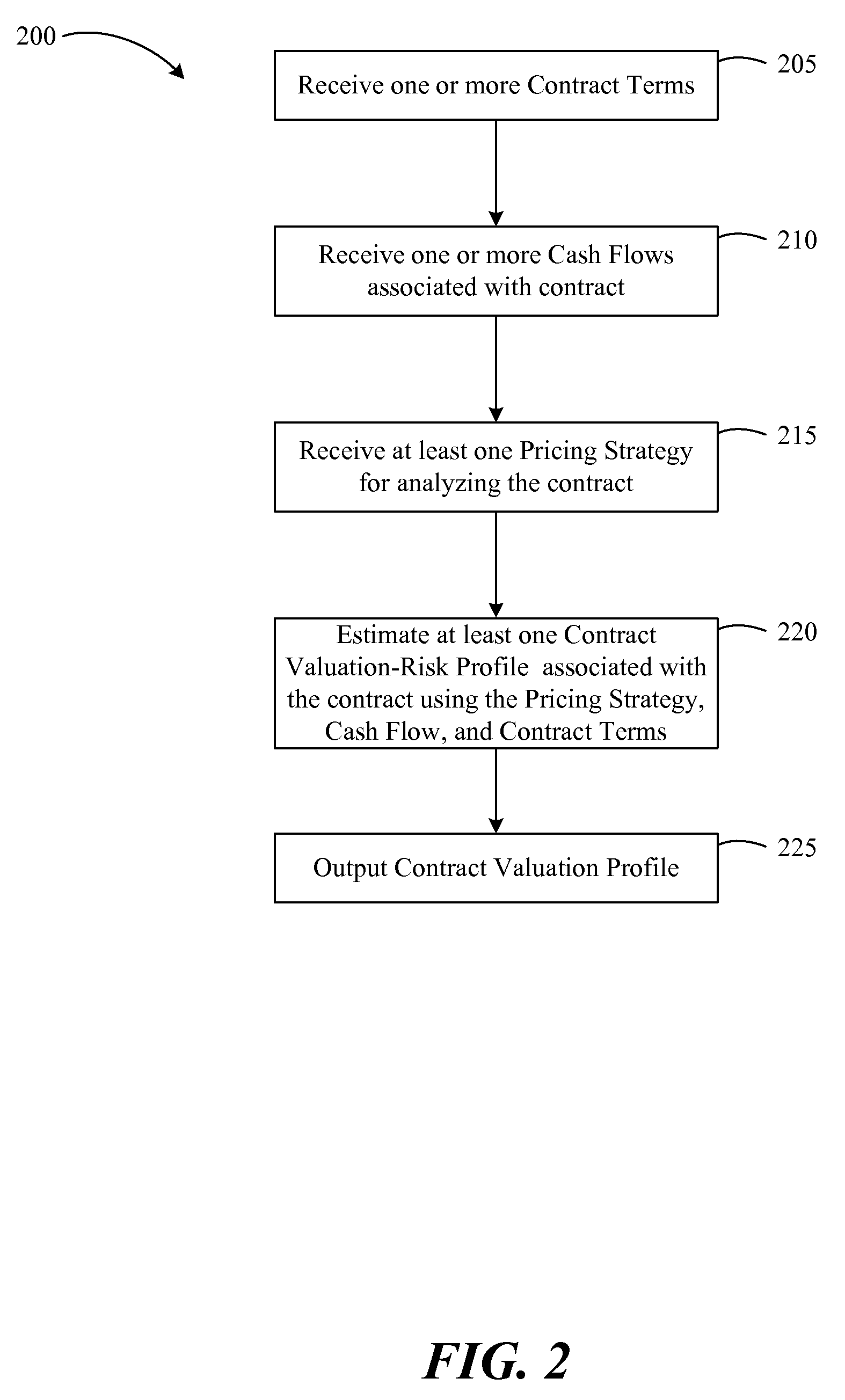

Systems and methods for analyzing a contract

Embodiments of the invention can provide systems and methods for analyzing a contract. According to one embodiment, a computer-implemented method for estimating a contract's profitability and risk exposure using various contract terms, potential cash flows, and pricing strategies can be provided. By estimating the contract's profitability and risk exposure across a variety of conditions, a valuation-risk profile is determined and can be presented to a user. The valuation-risk profile provides an objective value of any particular contract component and a quantitative framework for negotiation purposes. In addition, the valuation-risk profile can be used as part of a larger strategic plan, for risk assessment, and for general decision-making.

Owner:GENERAL ELECTRIC CO

Flexible Advertiser Billing System with Mixed Postpayment and Prepayment Capabilities

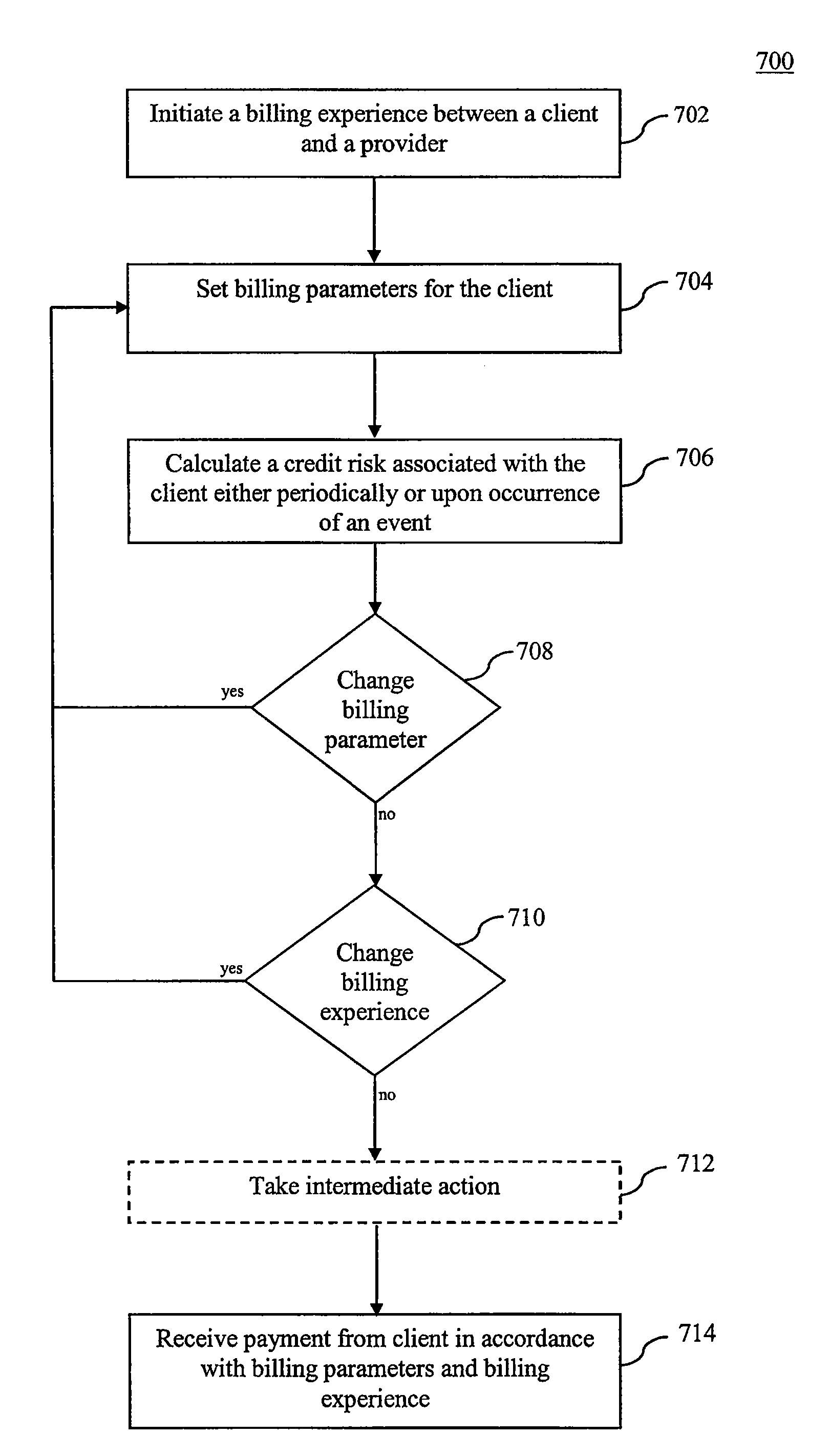

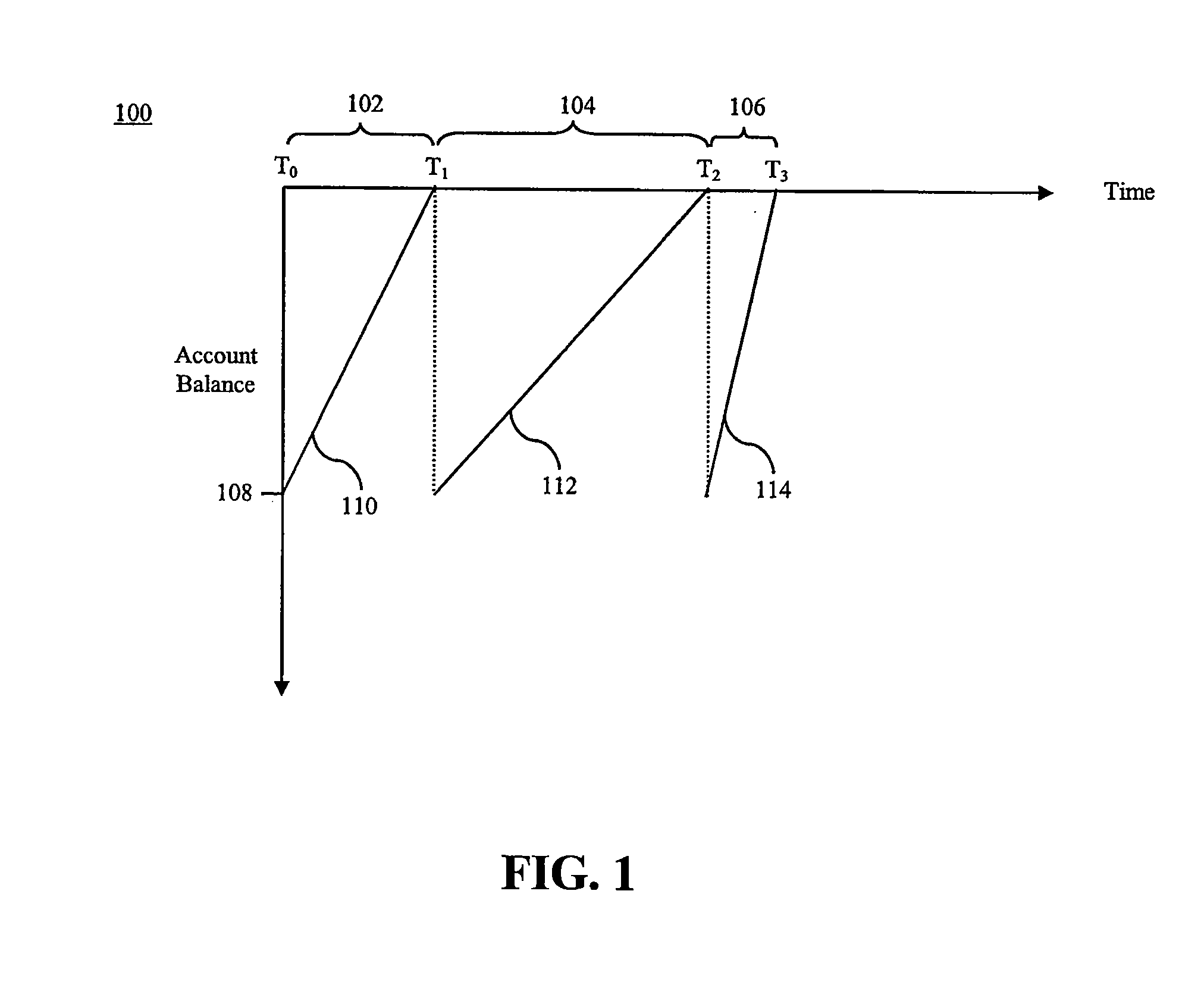

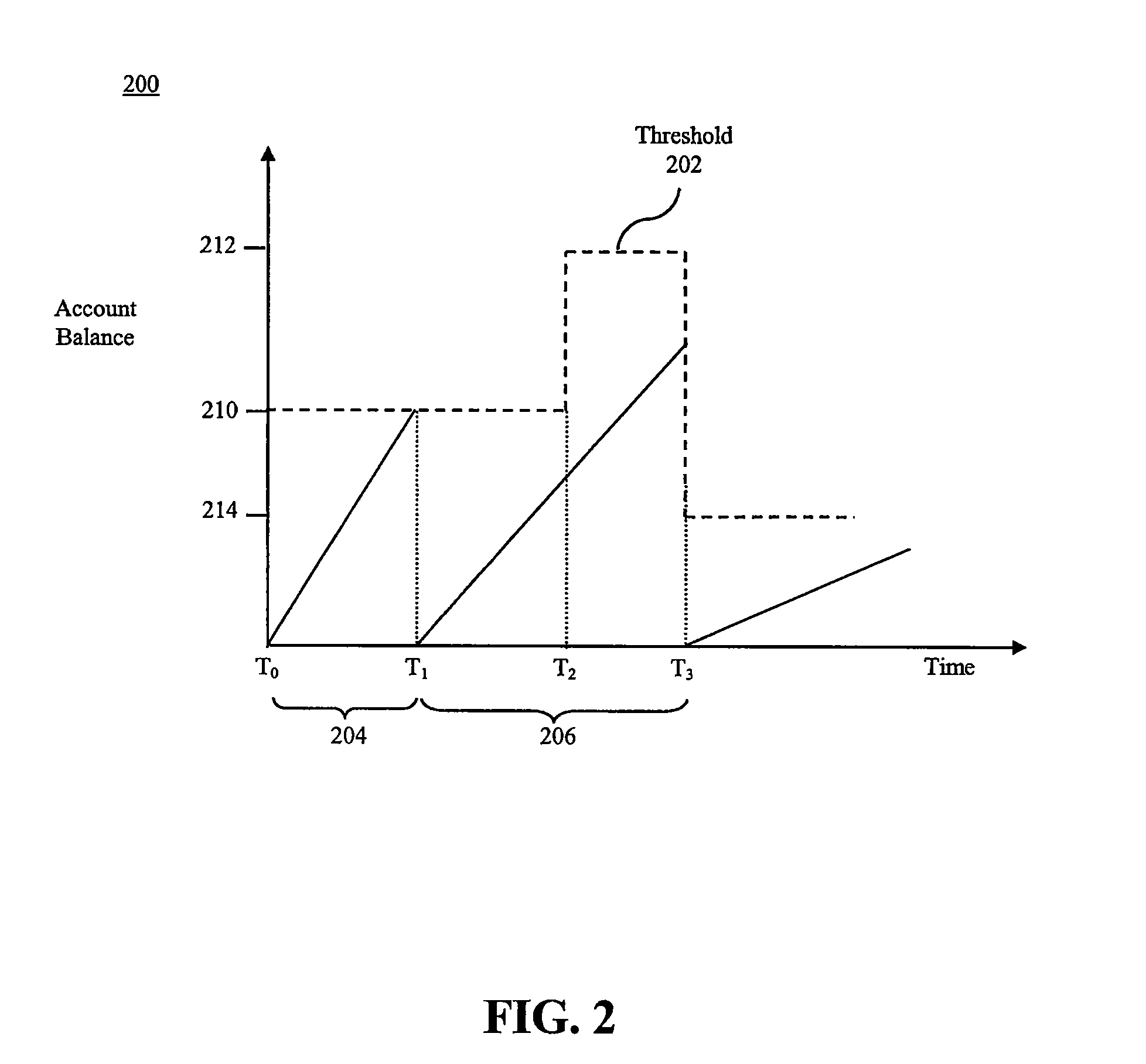

The present invention relates to systems and methods for managing risk in business transactions. In an embodiment, a computer-implemented method of managing risk exposure of a provide includes providing a product from the provider to a client under an initial billing experience between the provider and the client, evaluating a credit risk associated with the client at least one of periodically or upon occurrence of an event, and modifying a credit line the provider is willing to offer the client.

Owner:GOOGLE LLC

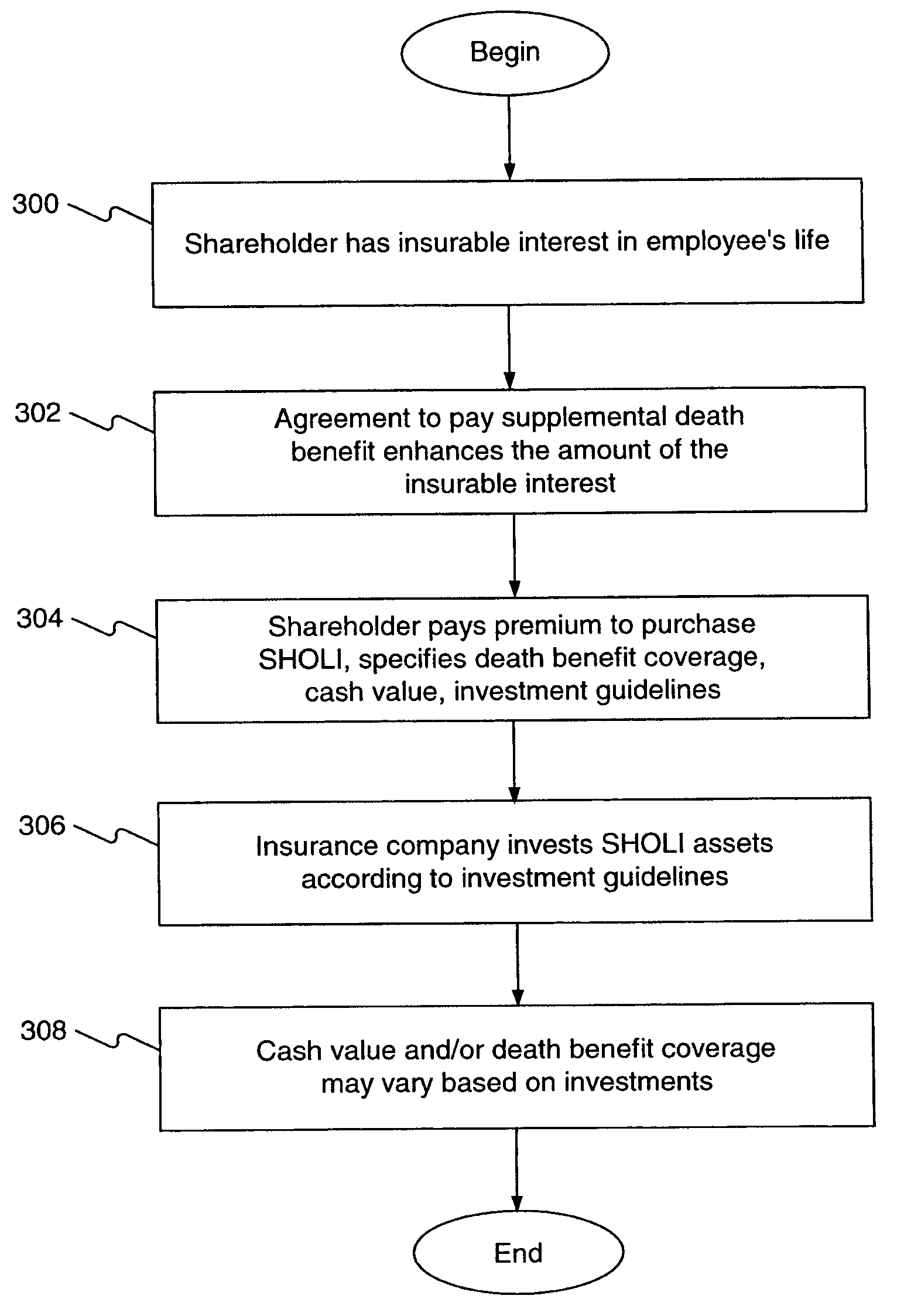

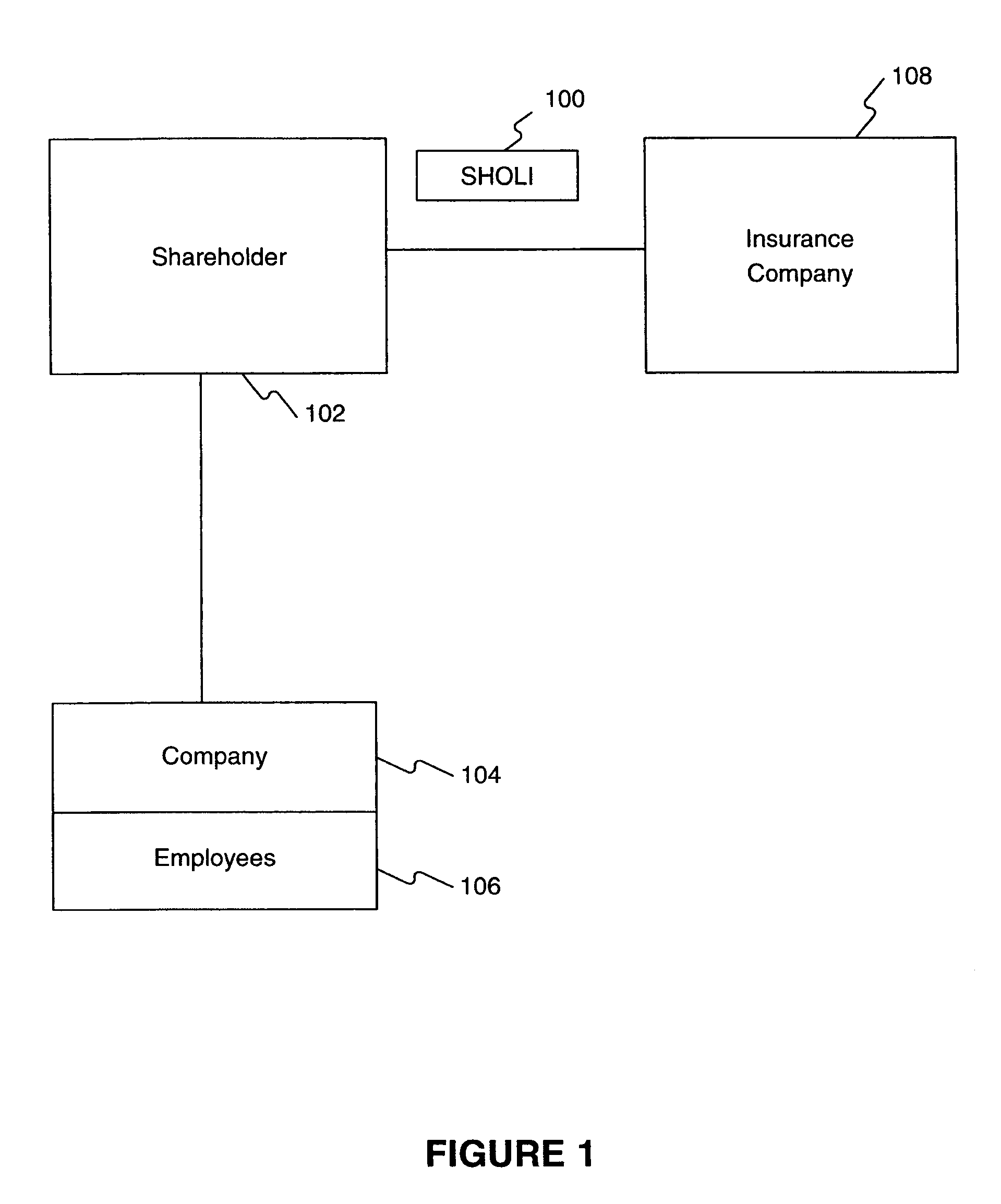

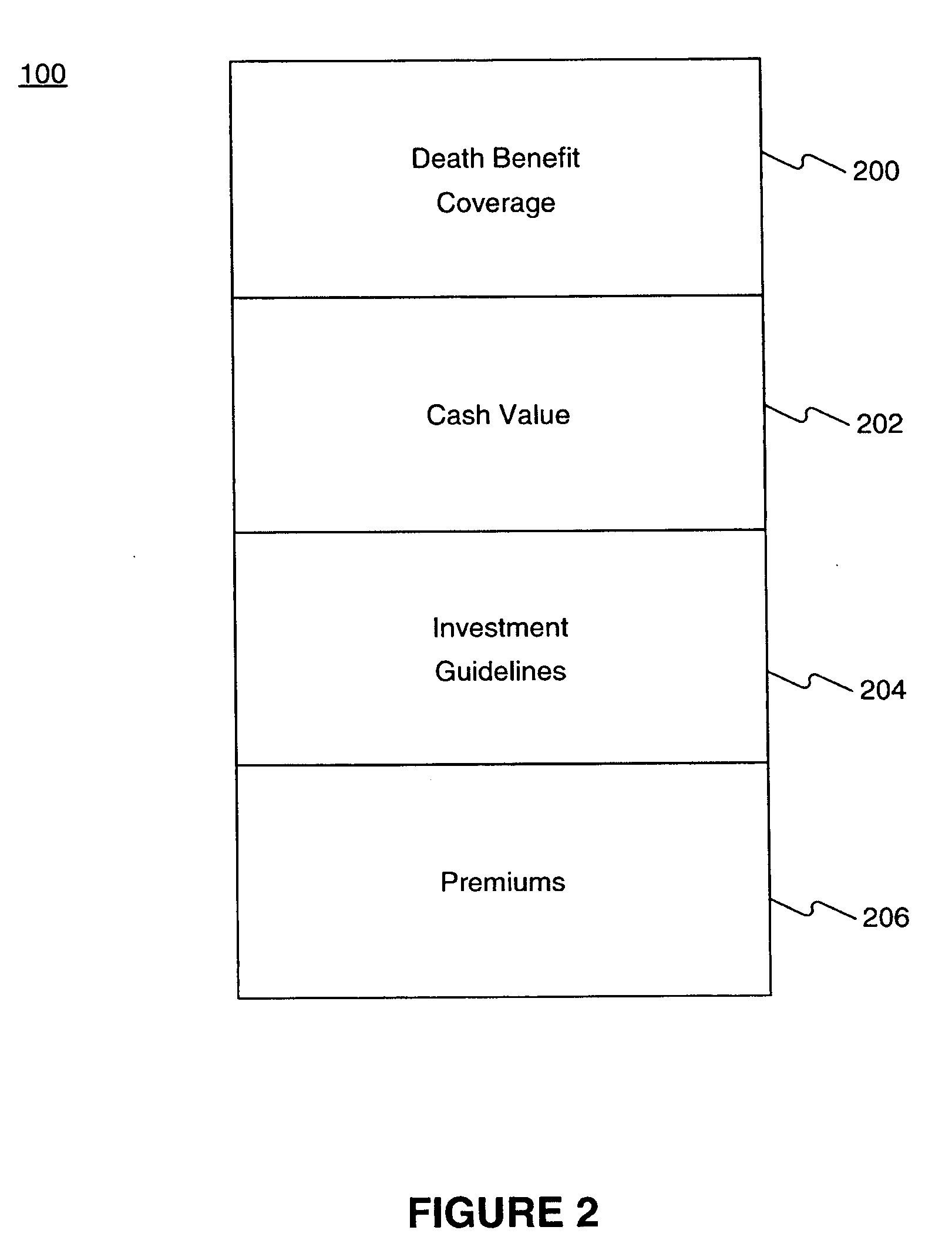

Shareholder-owned life insurance system and method

Systems and methods provide a shareholder-owned life insurance product enabling a shareholder in a small or closely held company to purchase a large-scale life insurance product, independent of the limited operating budget of his company, in which he can invest a large sum of private wealth. The shareholder can control risk exposure, obtain the tax benefits typically associated with an individual beneficiary life insurance policy, and achieve the cost savings of a large-scale corporation owned life insurance transaction, while avoiding the underwriting restrictions and costs associated with individual insureds and policies with large face amounts.

Owner:WINKLEVOSS

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com