Patents

Literature

241 results about "Credit line" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

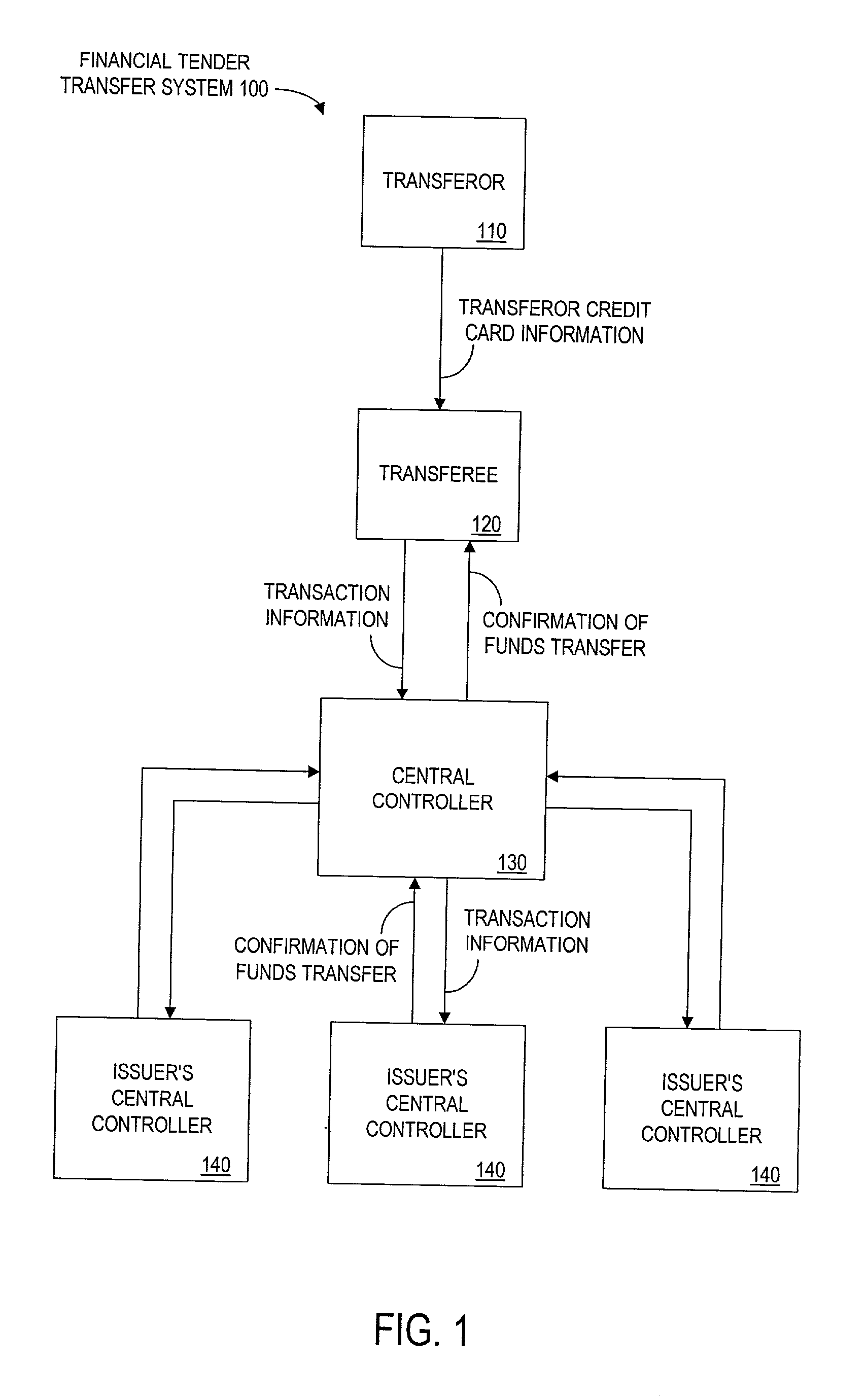

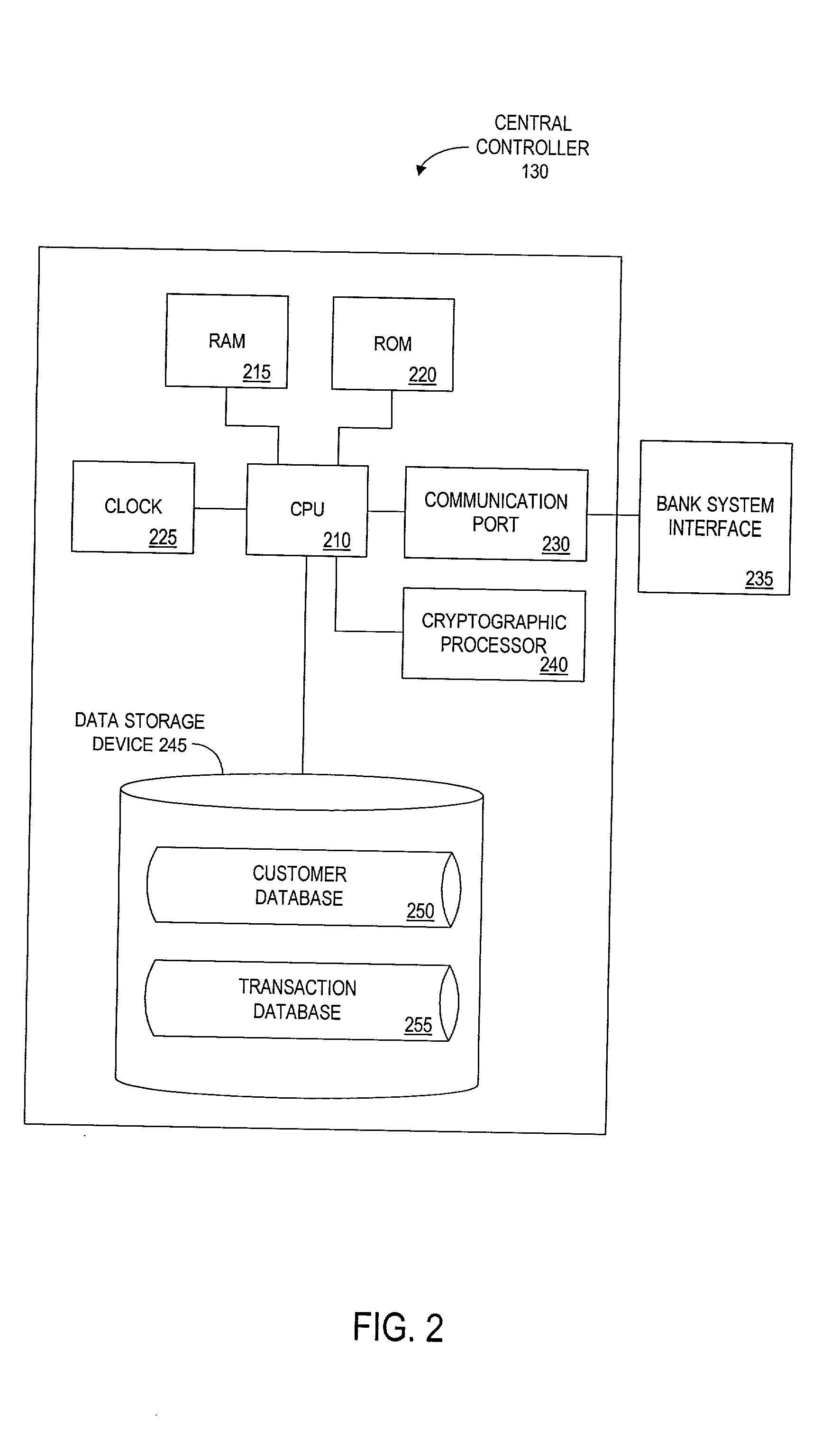

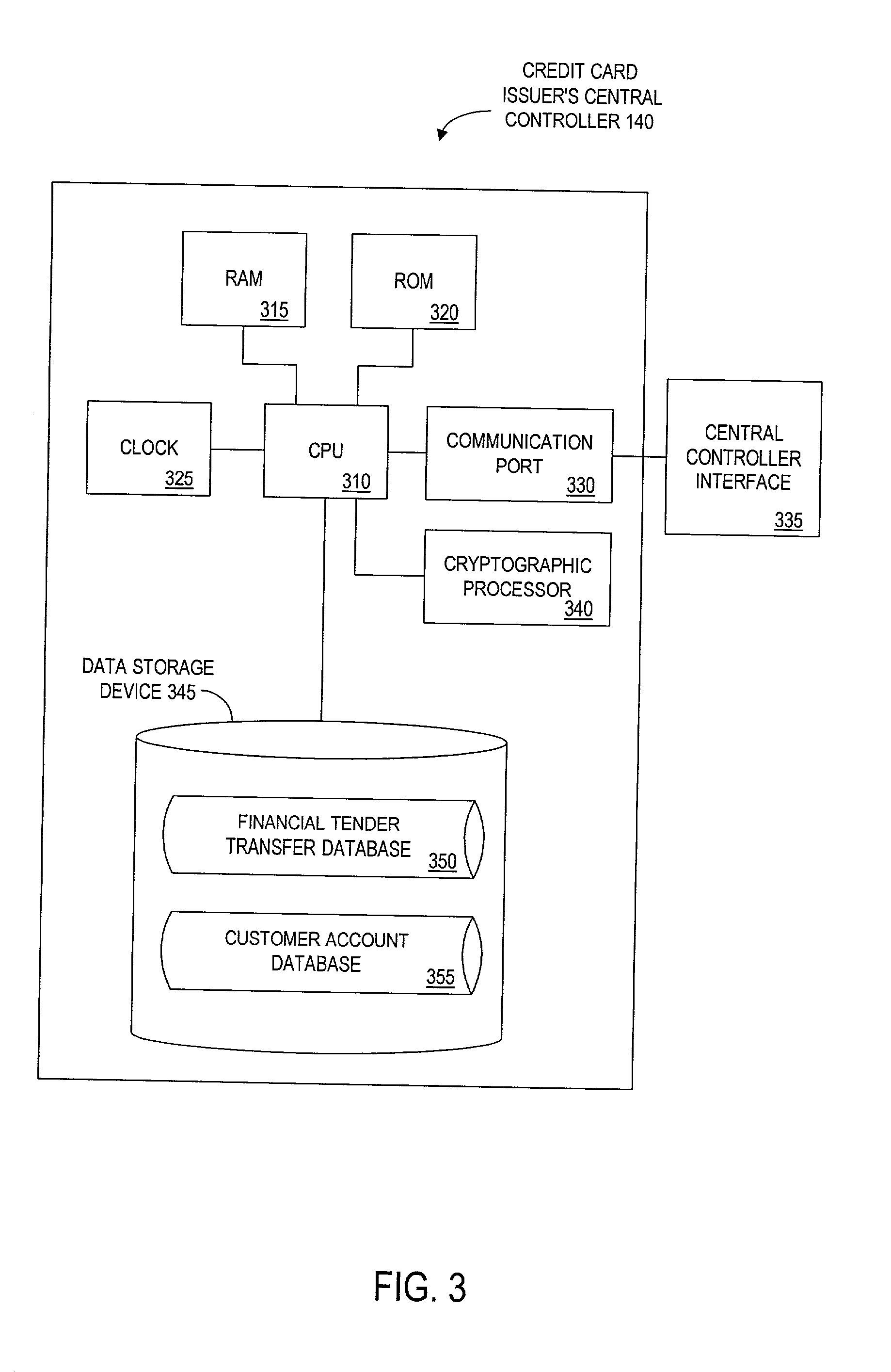

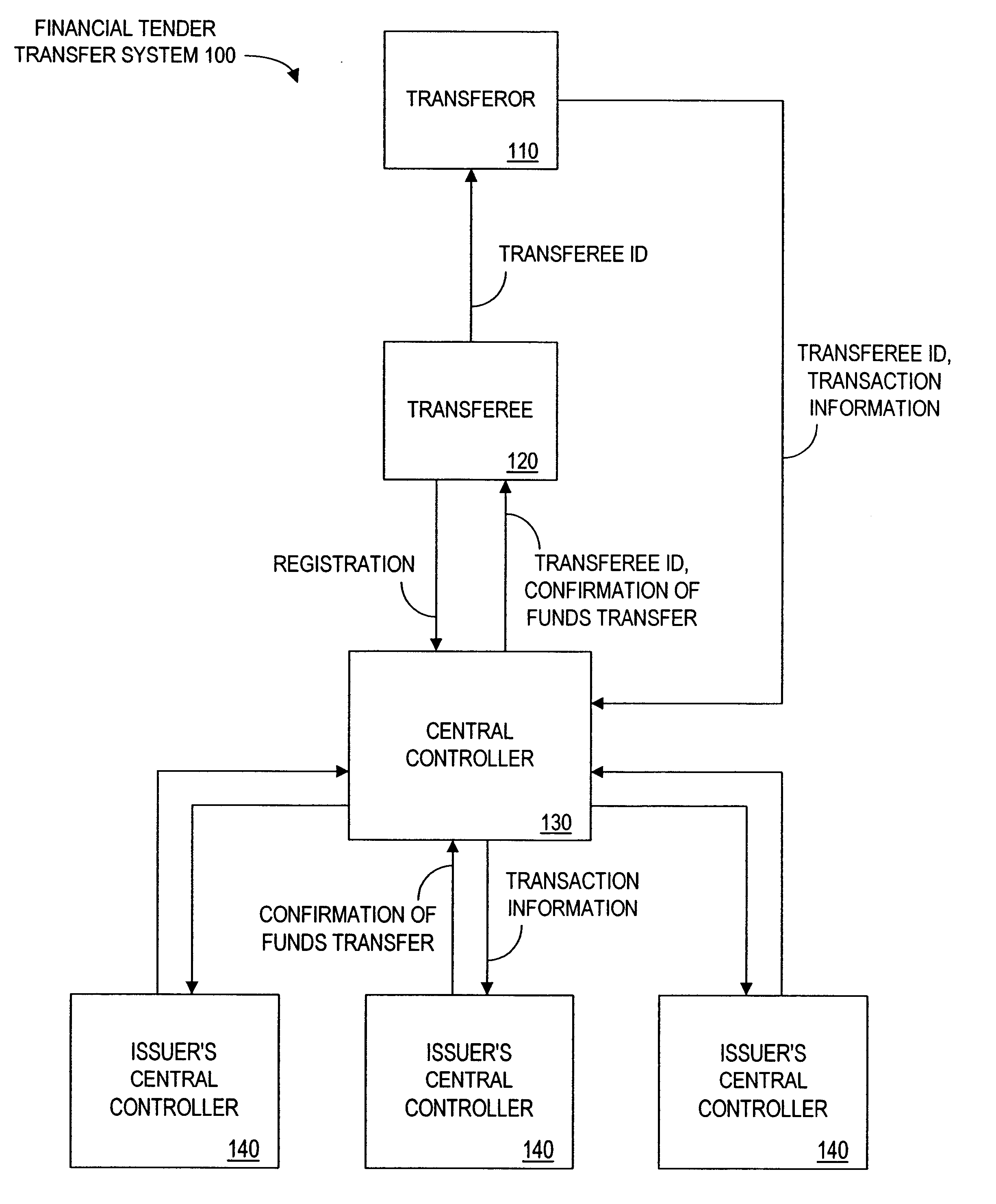

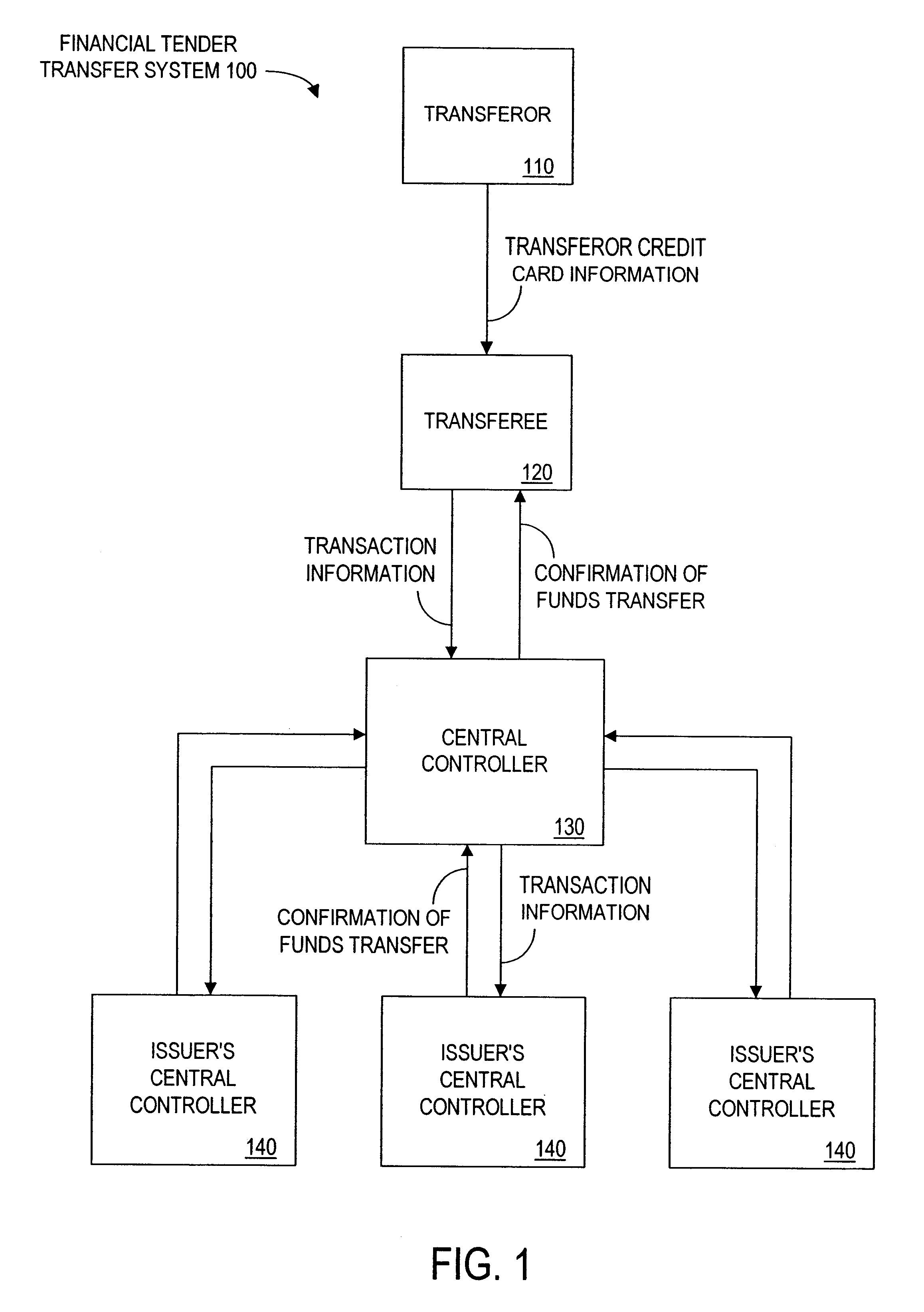

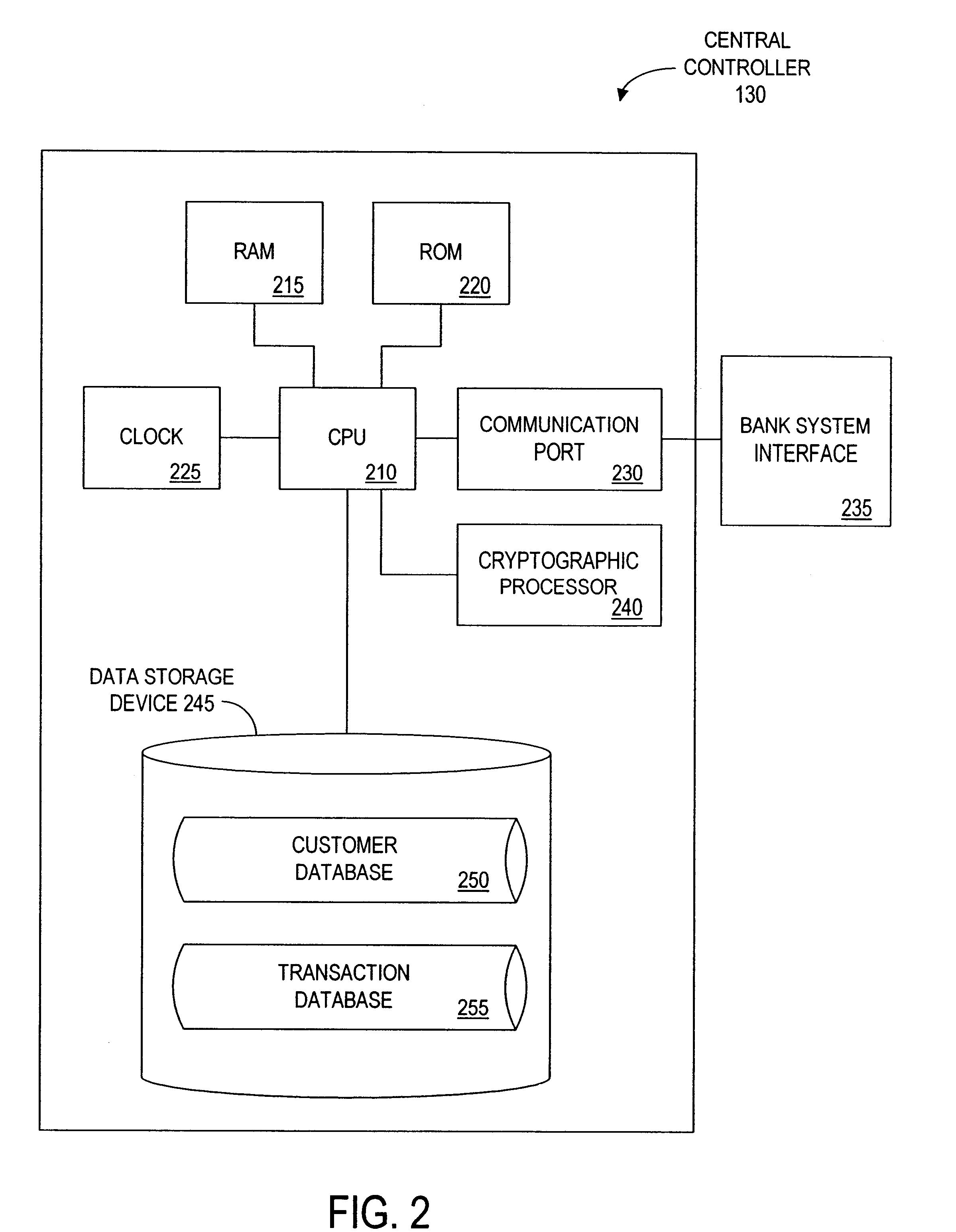

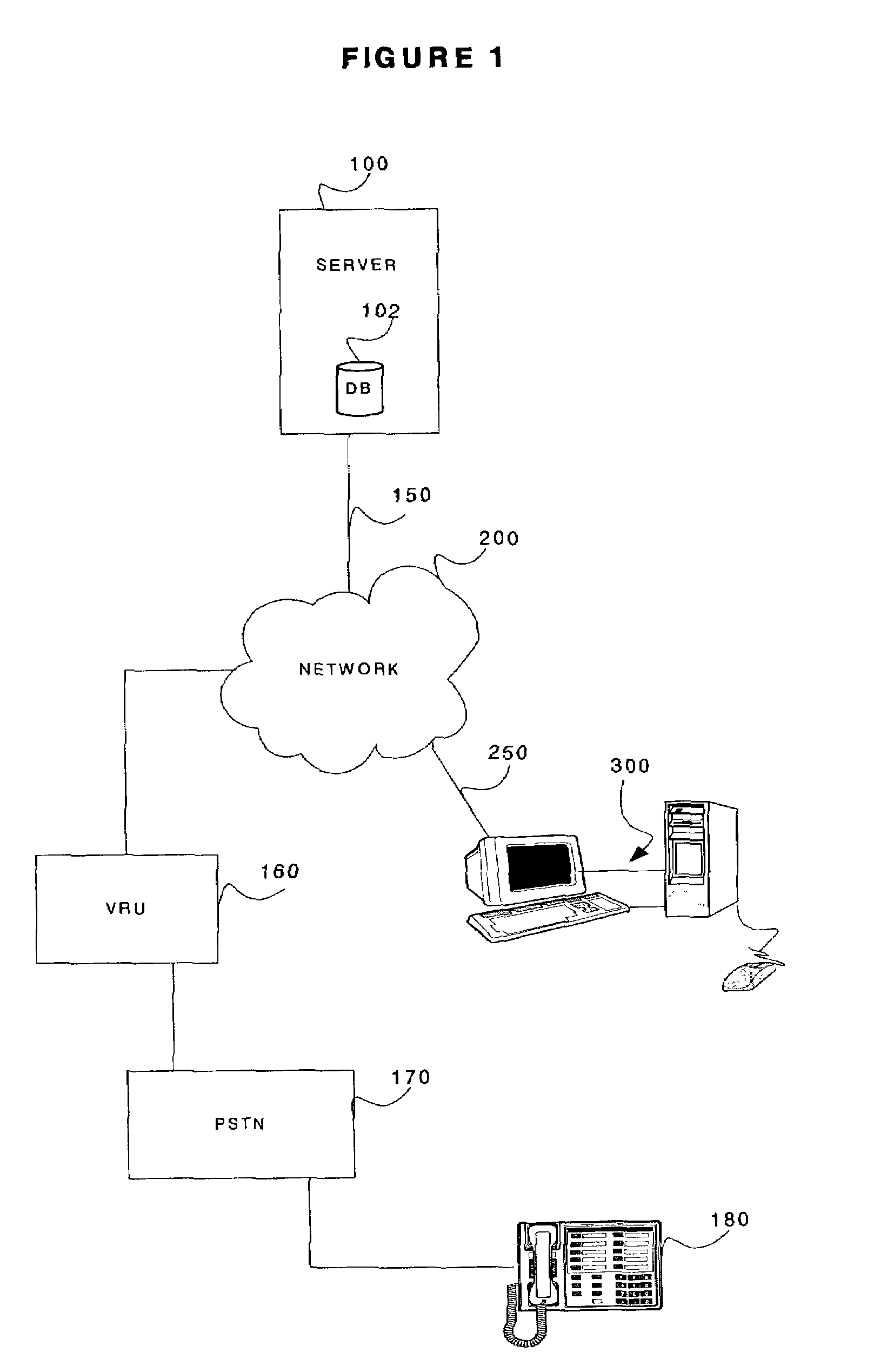

Method and apparatus for funds and credit line transfers

A financial tender transfer system allows a transferor to transfer credit or make payment to a transferee by debiting the credit card of the transferor and crediting the credit card of the transferee. The financial tender transfer system gives the transferee immediate access to the transferred money and ensures the transferor's credit card is valid. Neither party needs to give their credit card number to the other, so security is preserved. Any amount of value up to the full credit line of the transferor can be transferred to the transferee.

Owner:PAYPAL INC

Method and apparatus for funds and credit line transfers

A financial tender transfer system allows a transferor to transfer credit or make payment to a transferee by debiting the credit card of the transferor and crediting the credit card of the transferee. The financial tender transfer system gives the transferee immediate access to the transferred money and ensures the transferor's credit card is valid. Neither party needs to give their credit card number to the other, so security is preserved. Any amount of value up to the full credit line of the transferor can be transferred to the transferee.

Owner:PAYPAL INC

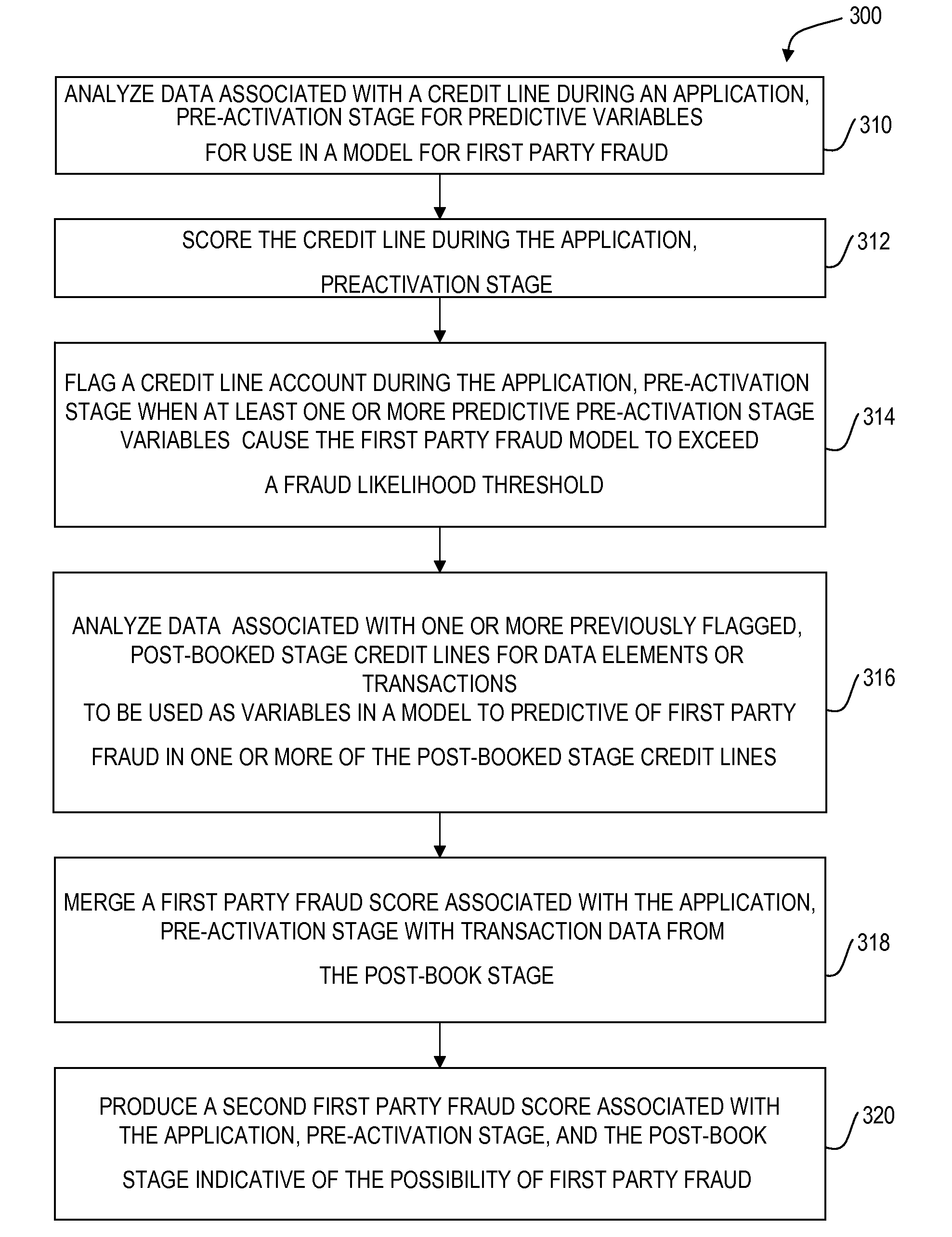

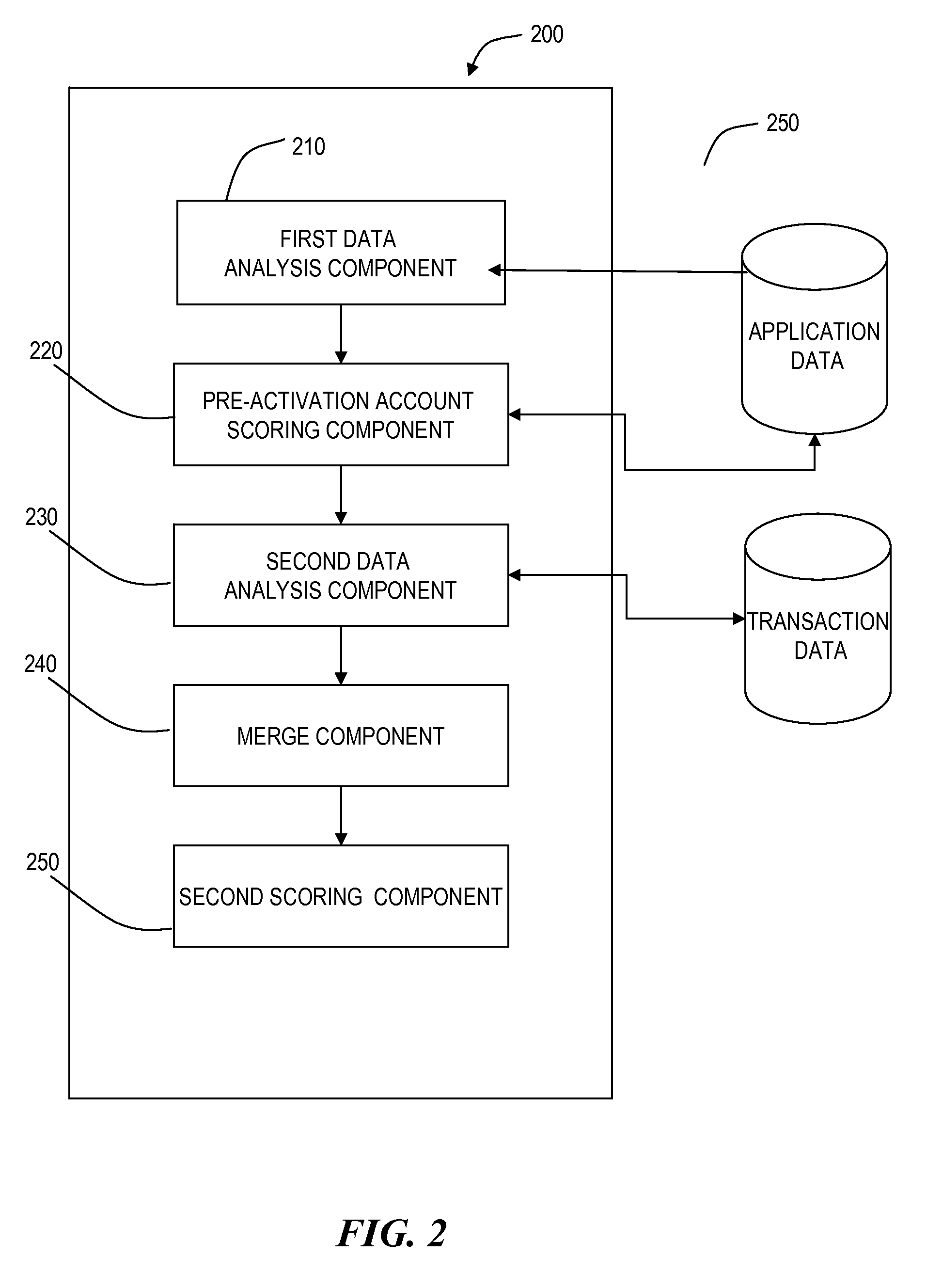

Detecting first party fraud abuse

InactiveUS20090222308A1Exposure was also limitedLittle recourseComplete banking machinesFinanceAlgorithmPredictive value

A computerized method includes analyzing data associated with a credit line during an origination stage for predictive variables for use in a model for first party fraud, and flagging an account during the origination stage when at least one or more predictive origination stage variables cause a model score to exceed a pre-defined fraud likelihood threshold. The computerized method also includes analyzing data associated with one or more previously flagged, post-booked stage credit lines for data elements or transactions to be used as variables in a model to predictive of first party fraud at the customer-level or in one or more of the post-booked stage credit lines.

Owner:FAIR ISAAC & CO INC

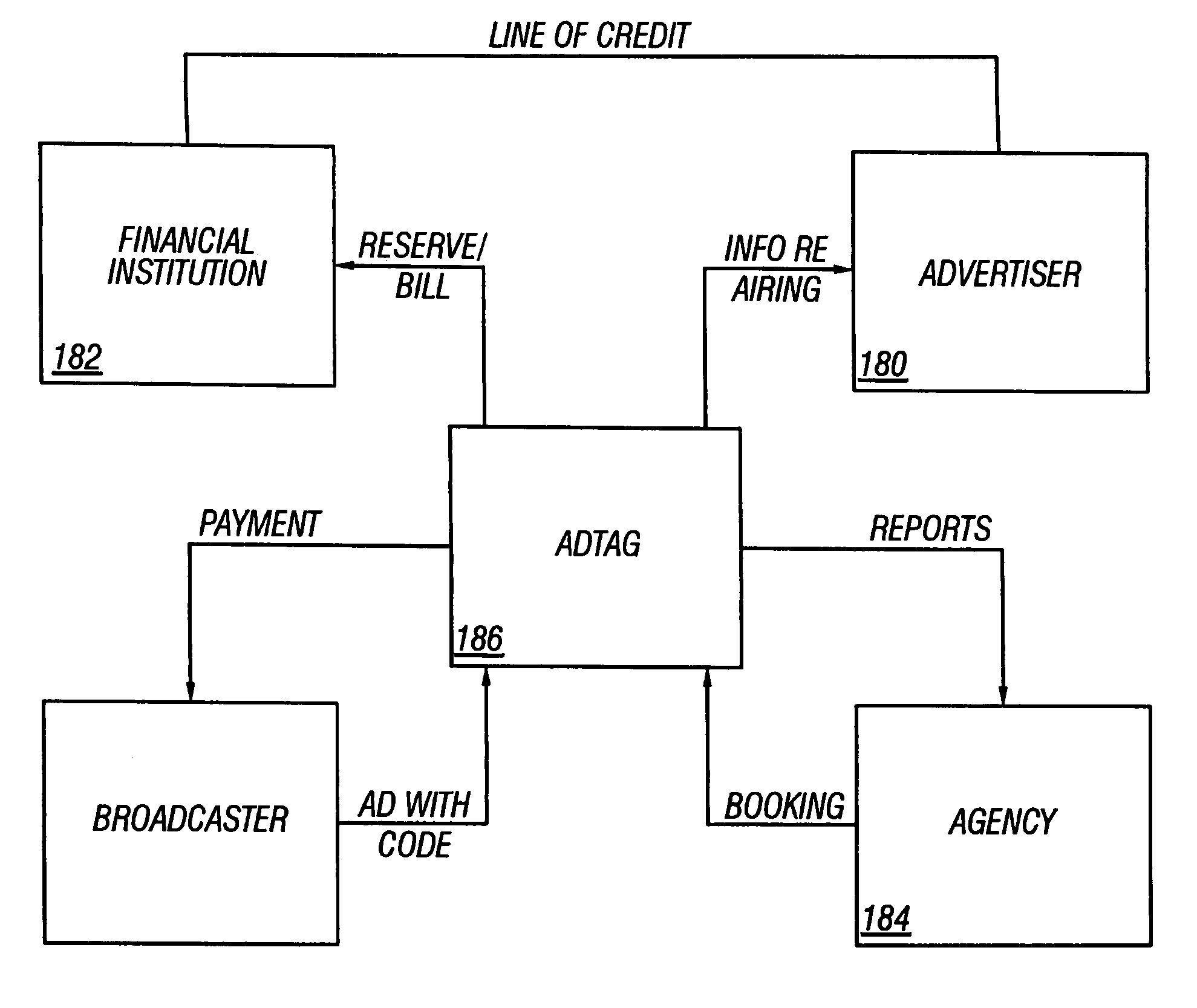

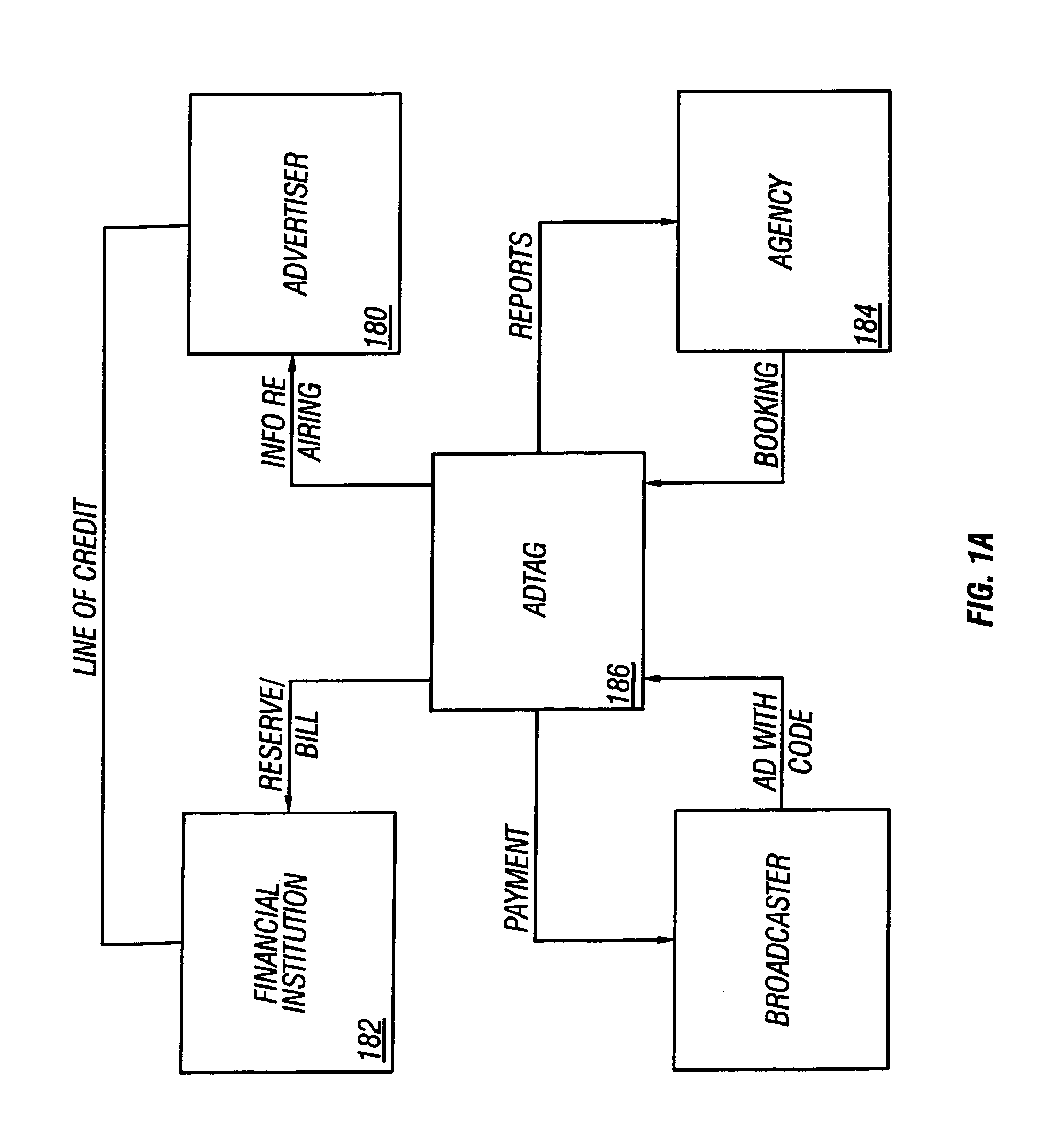

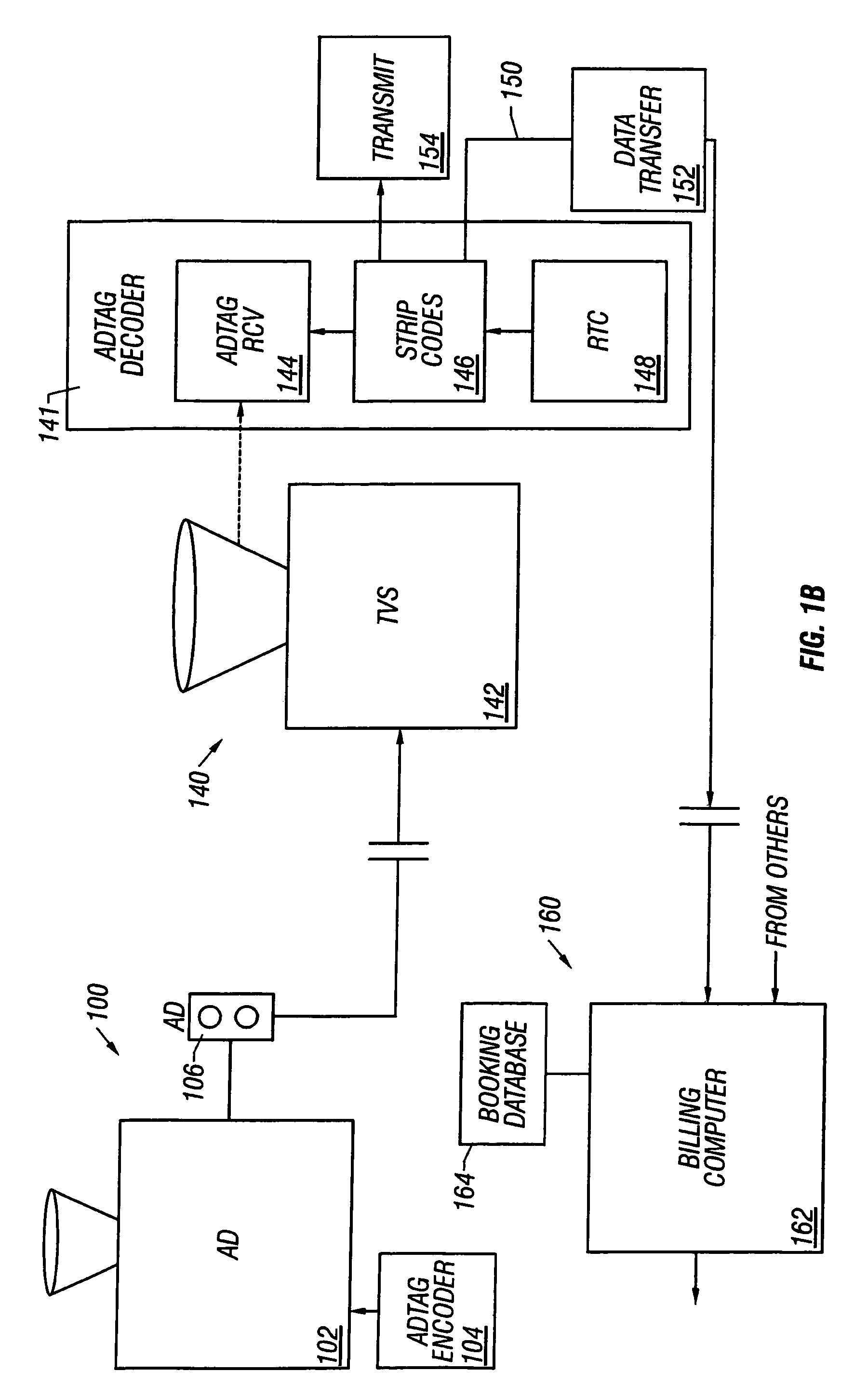

Television advertising automated billing system

InactiveUS7039930B1Avoid possibilityAccurate accountingAdvertisementsPicture reproducers using cathode ray tubesPaymentClosed captioning

Advertising is marked with a code in a way which makes it difficult to fool the system. The advertising is marked with a code at the time the advertising is produced. Then, when the advertising is broadcast, the code on the advertising is analyzed. Different security measures can be used, including producing the code in the closed captioning so that many different people can see the code, or comparing codes in one part of the signal with a code in another part of the signal. Measures are taken to prevent the code from being used to detect commercials. According to another part of this system, a paradigm for a clearinghouse is disclosed in which the user signs up with the clearinghouse, obtains a line of credit, and the advertiser, the agency, and the ad producer also subscribe to the service. When the ad is actually aired, the payment can be automatically transferred.

Owner:CALIFORNIA INST OF TECH

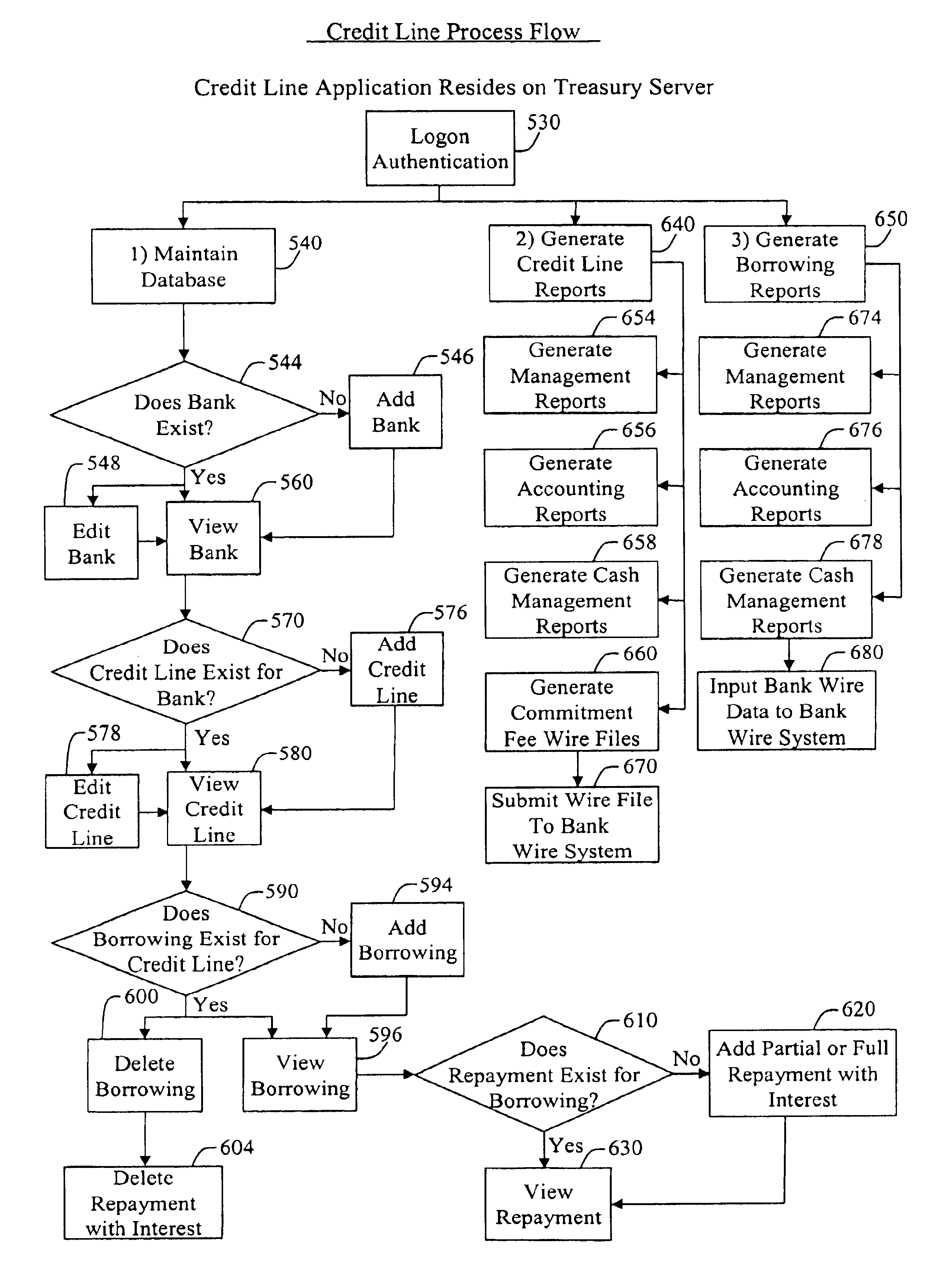

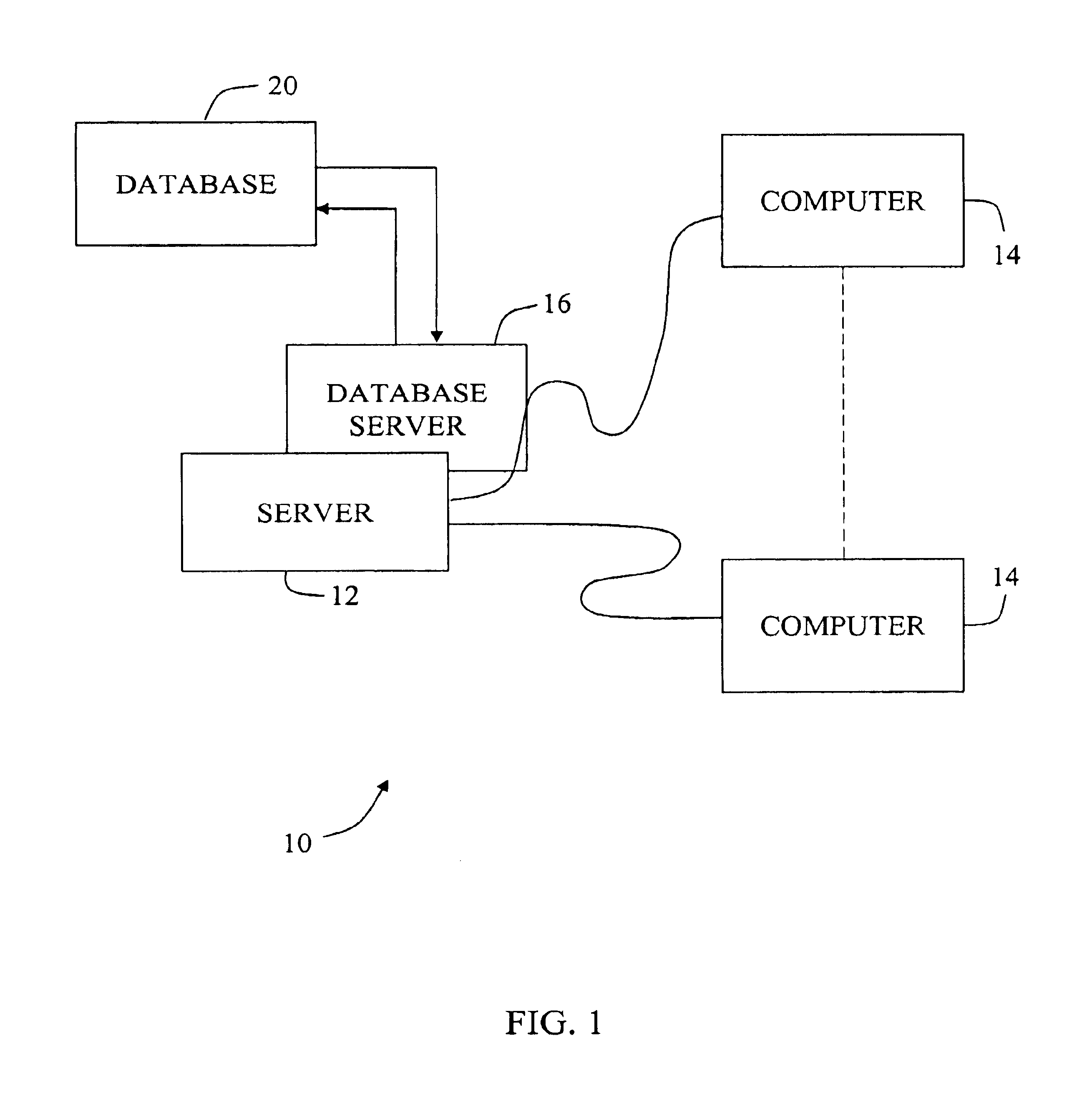

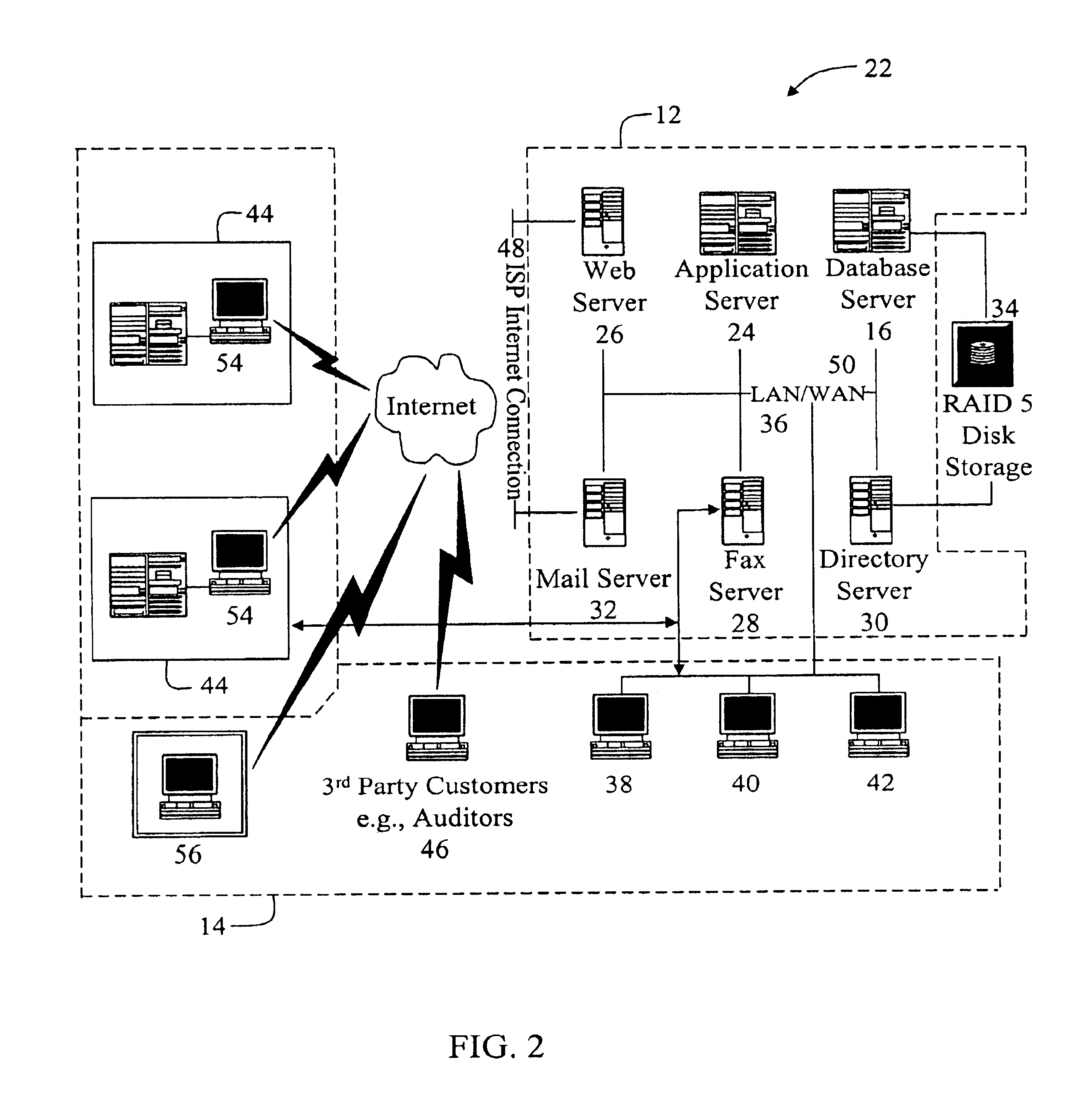

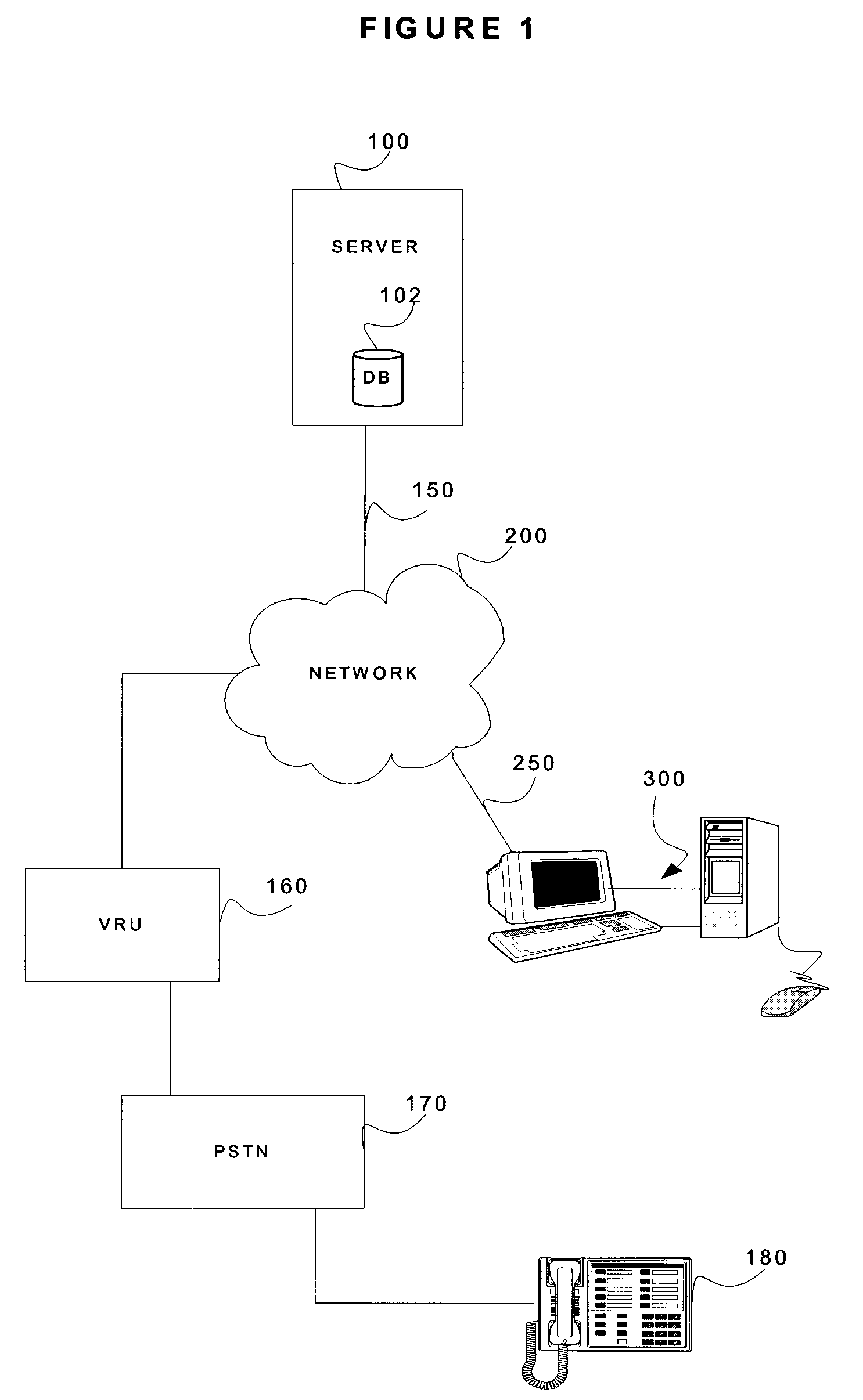

Systems and methods for credit line monitoring

InactiveUS6873972B1Facilitates efficient credit line monitoringFinanceCredit schemesCentralized databaseCentral database

In one embodiment, the present invention is a method and a system for tracking bank credit lines and borrowing. The method involves tracking credit ratings of a bank, requesting the bank to establish a line of credit, accessing a centralized database to obtain and maintain information regarding the line of credit, automatically transmitting domestic and international wire information for cash movement to the bank, and finally posting borrowing journal entries to a general ledger for financial monitoring, reporting and auditing purposes. The method and the system are capable of handling multi-currency transactions involving domestic and international banks.

Owner:GENERAL ELECTRIC CO

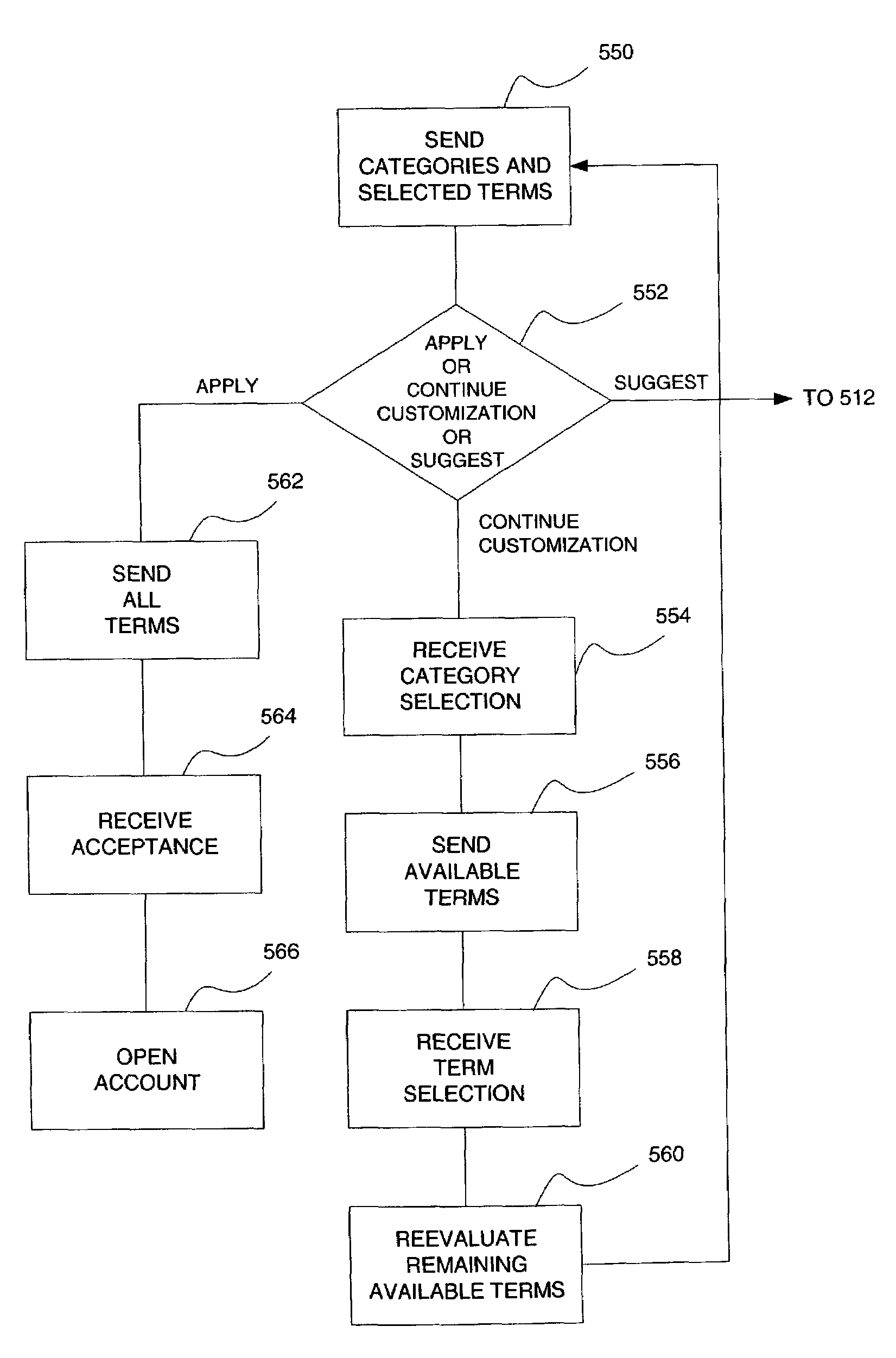

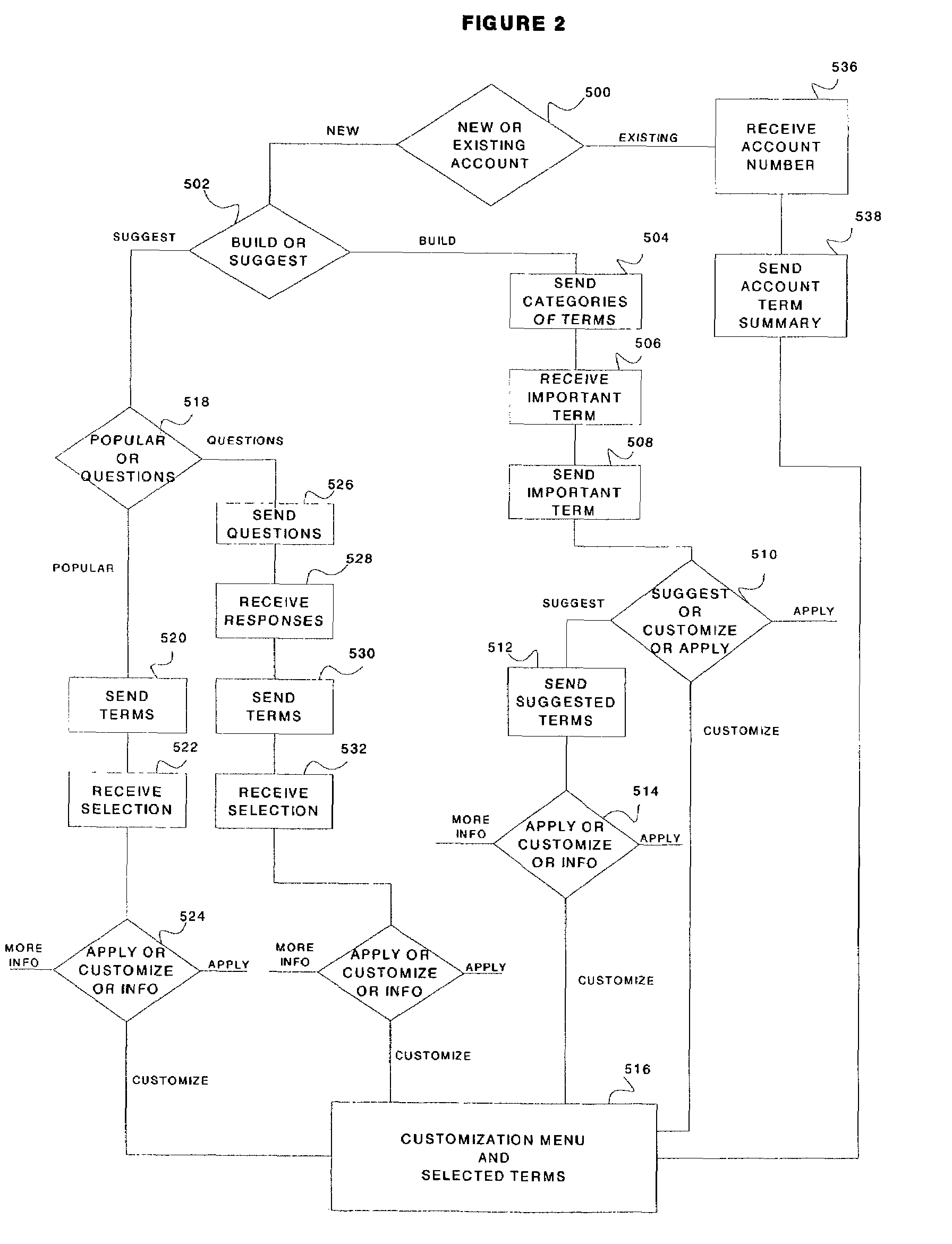

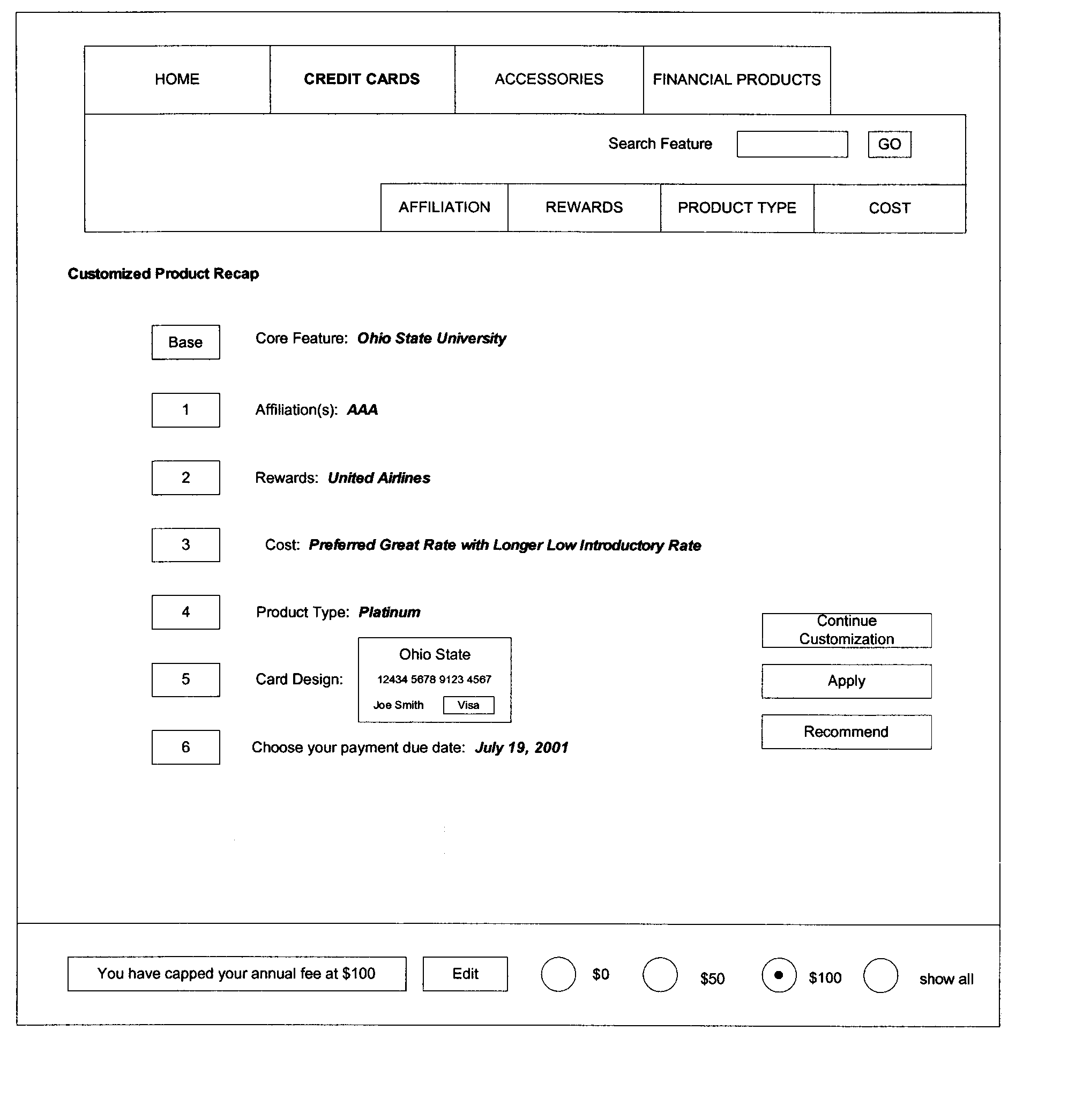

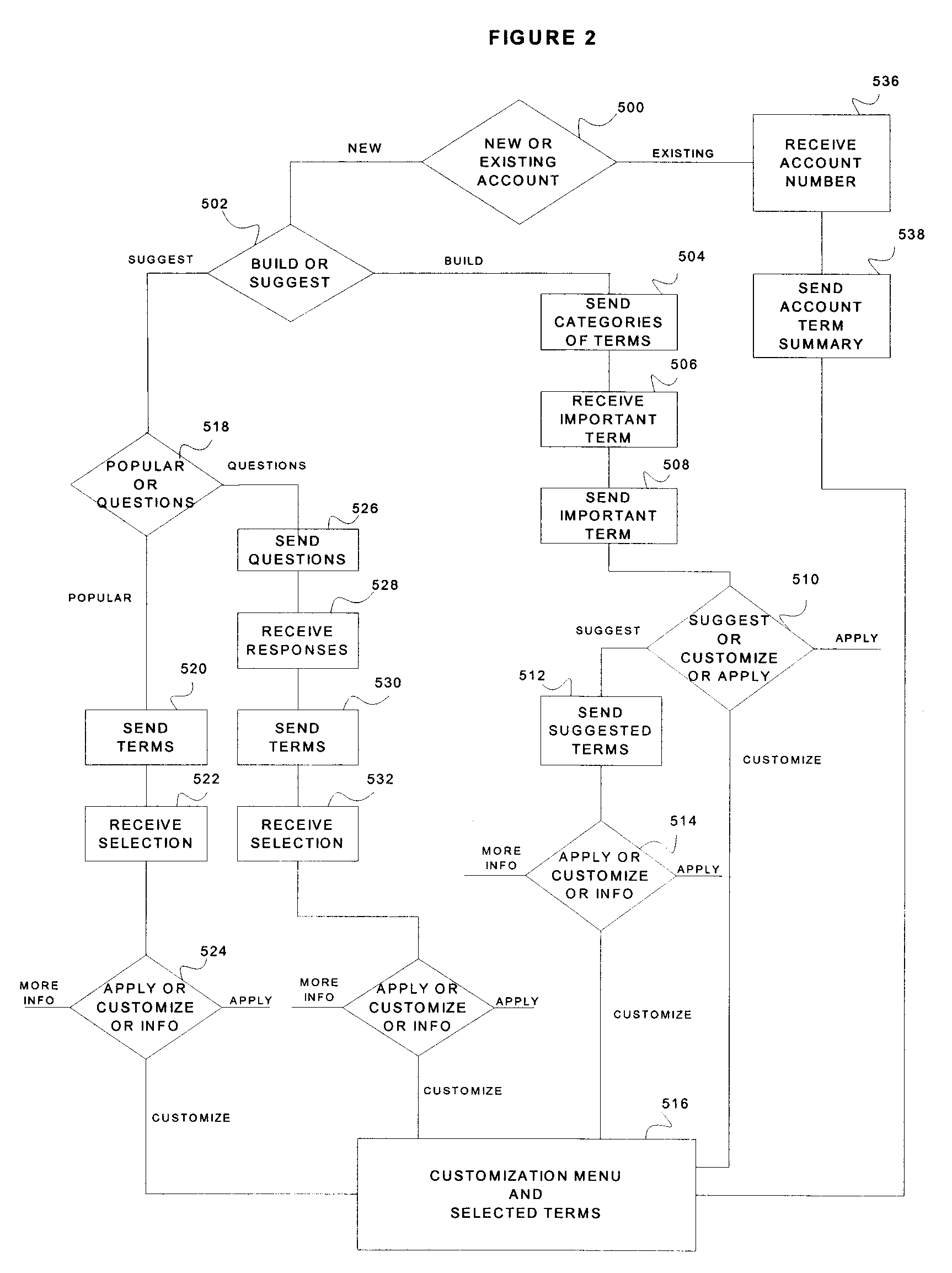

System and method for establishing or modifying an account with user selectable terms

ActiveUS7689504B2Easily customizedEasy to updateFinancePayment architectureIssuing bankService provision

The present invention relates to methods for allowing an account holder to easily customize the terms of an account such as a loan account, an asset account, a mortgage account, an insurance account, or a brokerage account. Exemplary embodiments of the invention allow the user to specify various preferred terms such as cost (e.g., APR and annual fee), rewards programs, card design, affiliates, credit line, and payment due date, among others. The financial service provider issuing the account, e.g., the issuing bank, may make the various available terms for the account easily accessible to the user, for example through an internet website or an automated phone system, enabling the user to easily specify his or her preferences. The customization methods may be applied to the process of opening a new account or customizing an existing account. The customization methods may dynamically update the available terms as the user begins to select his or her desired terms.

Owner:JPMORGAN CHASE BANK NA

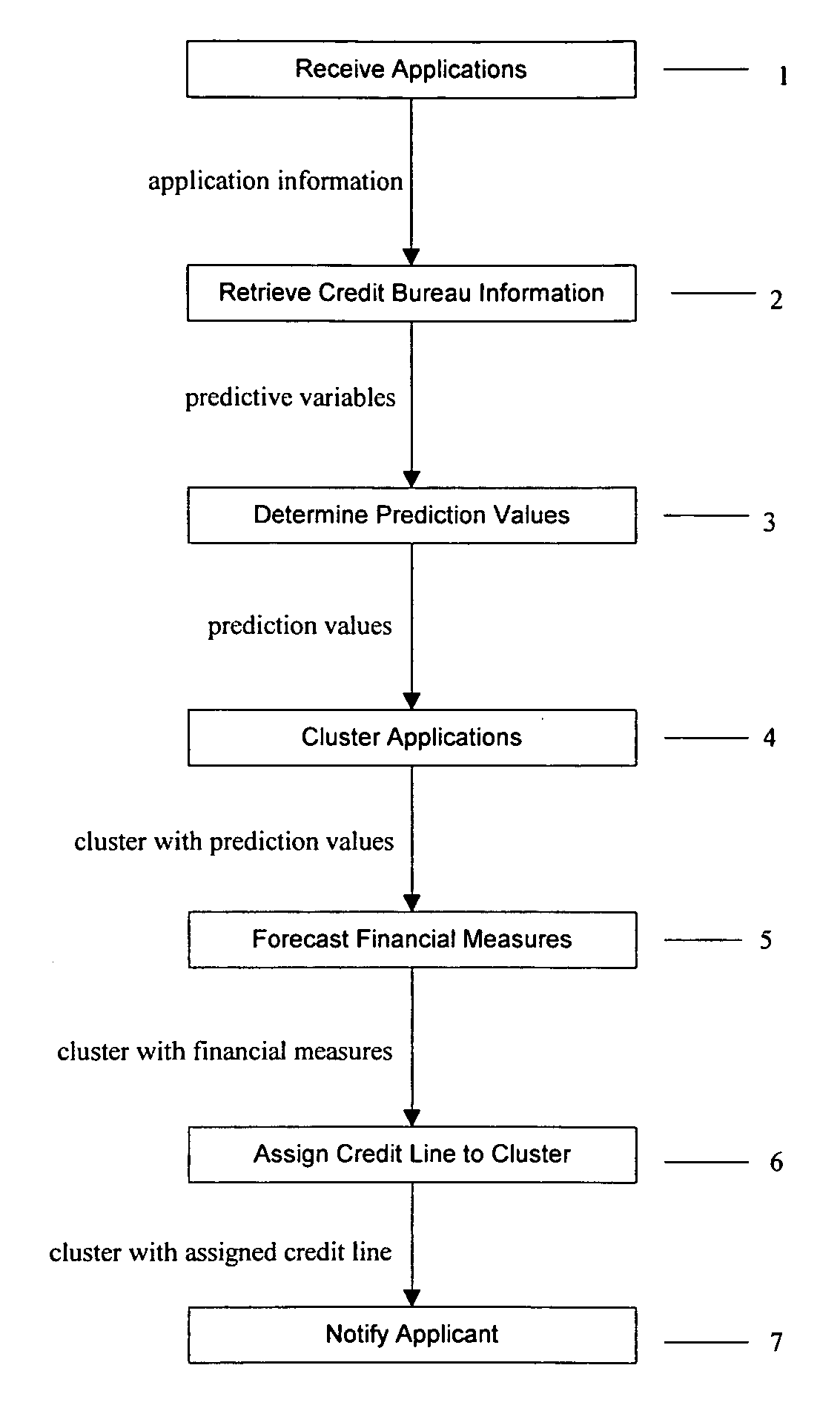

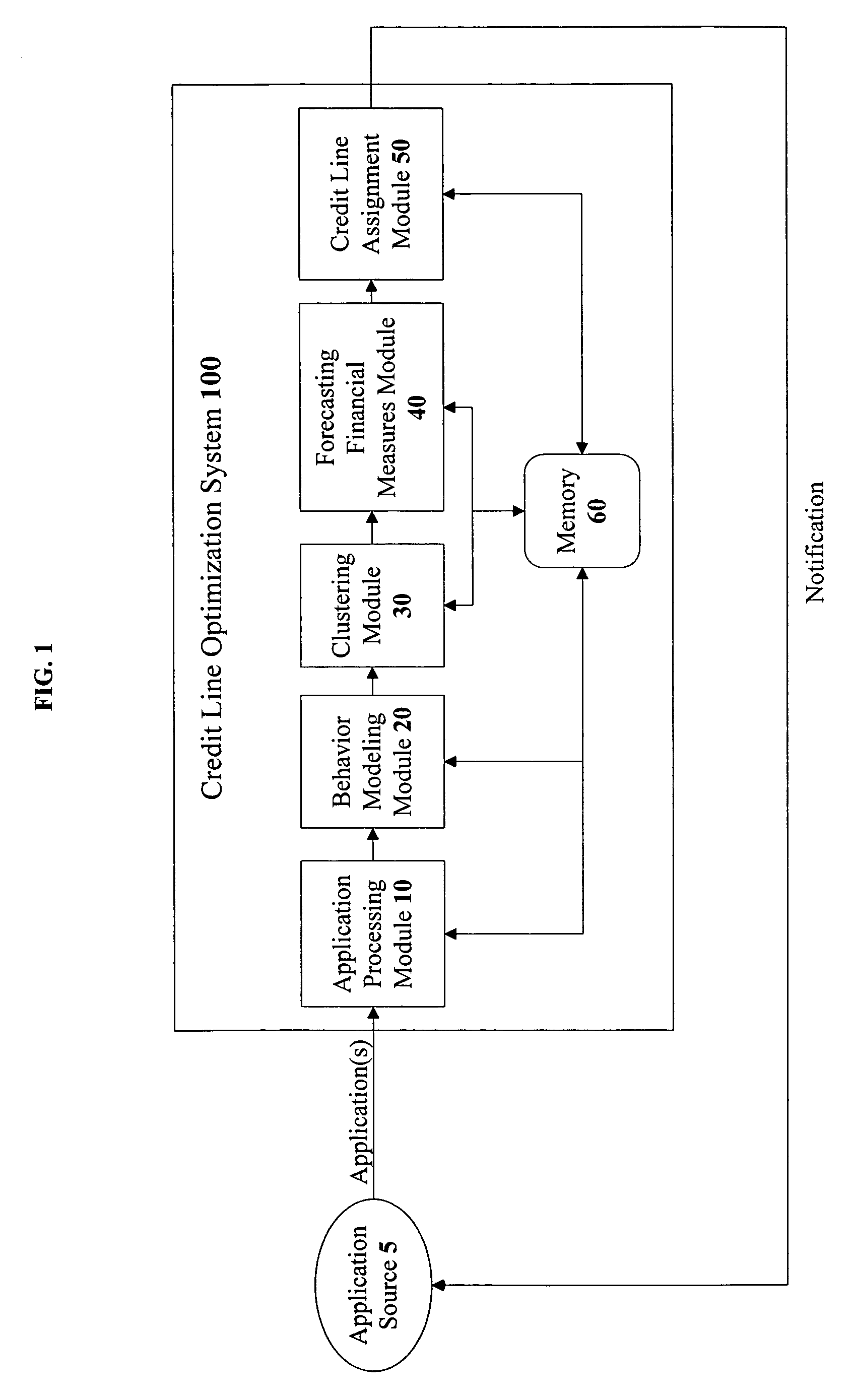

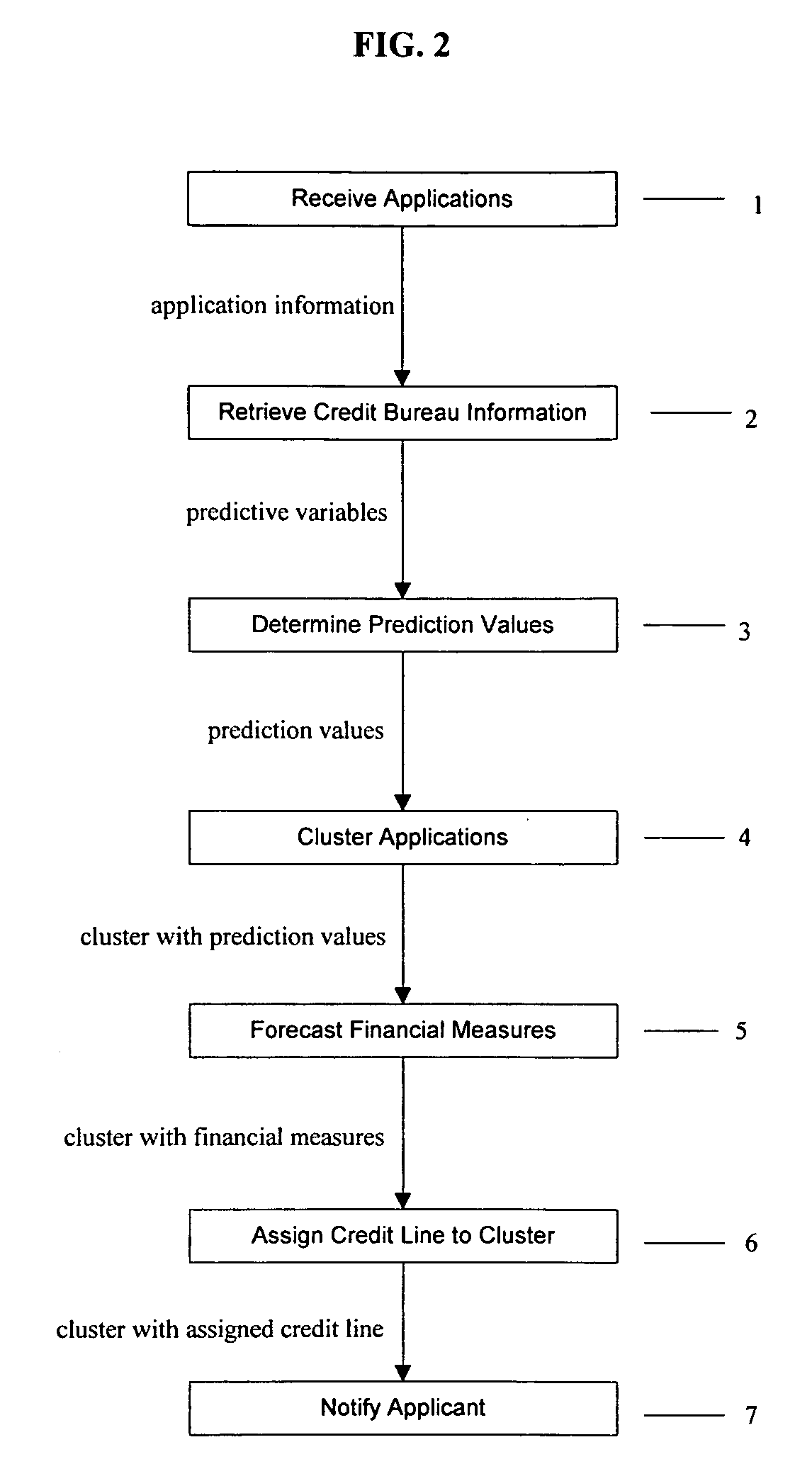

Credit line optimization

In a system for assigning a credit line to a credit card application, the system receives a plurality of credit card applications each having applicant information. For each application, the system retrieves credit bureau information. The applicant information and the credit bureau information are used to model the likely behavior of the corresponding applicant. The applications are clustered into one or more clusters according to the modeled behavior. For each cluster of applications, financial measures are forecasted and analyzed to determine the optimal credit line to assign to the cluster.

Owner:JPMORGAN CHASE BANK NA

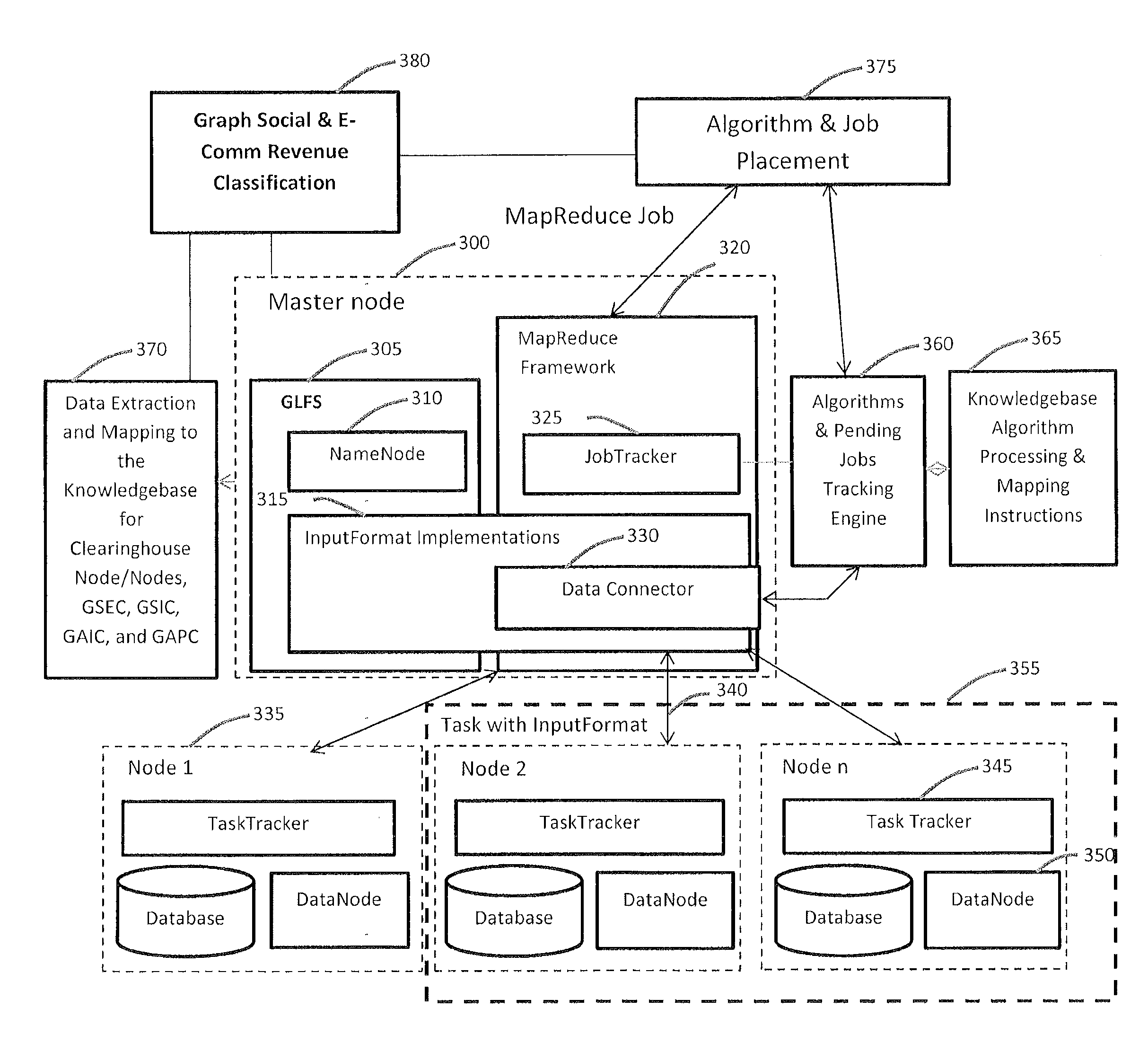

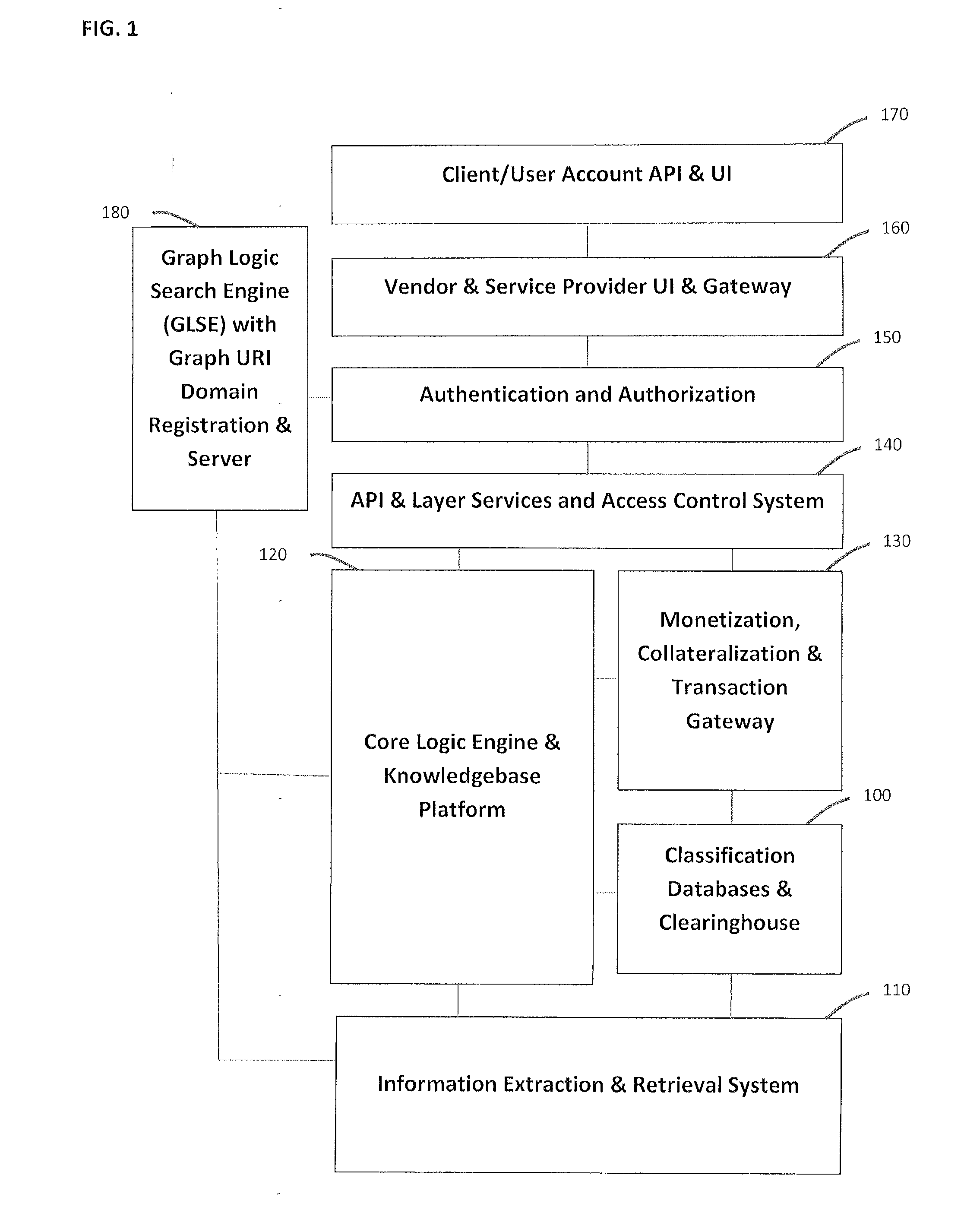

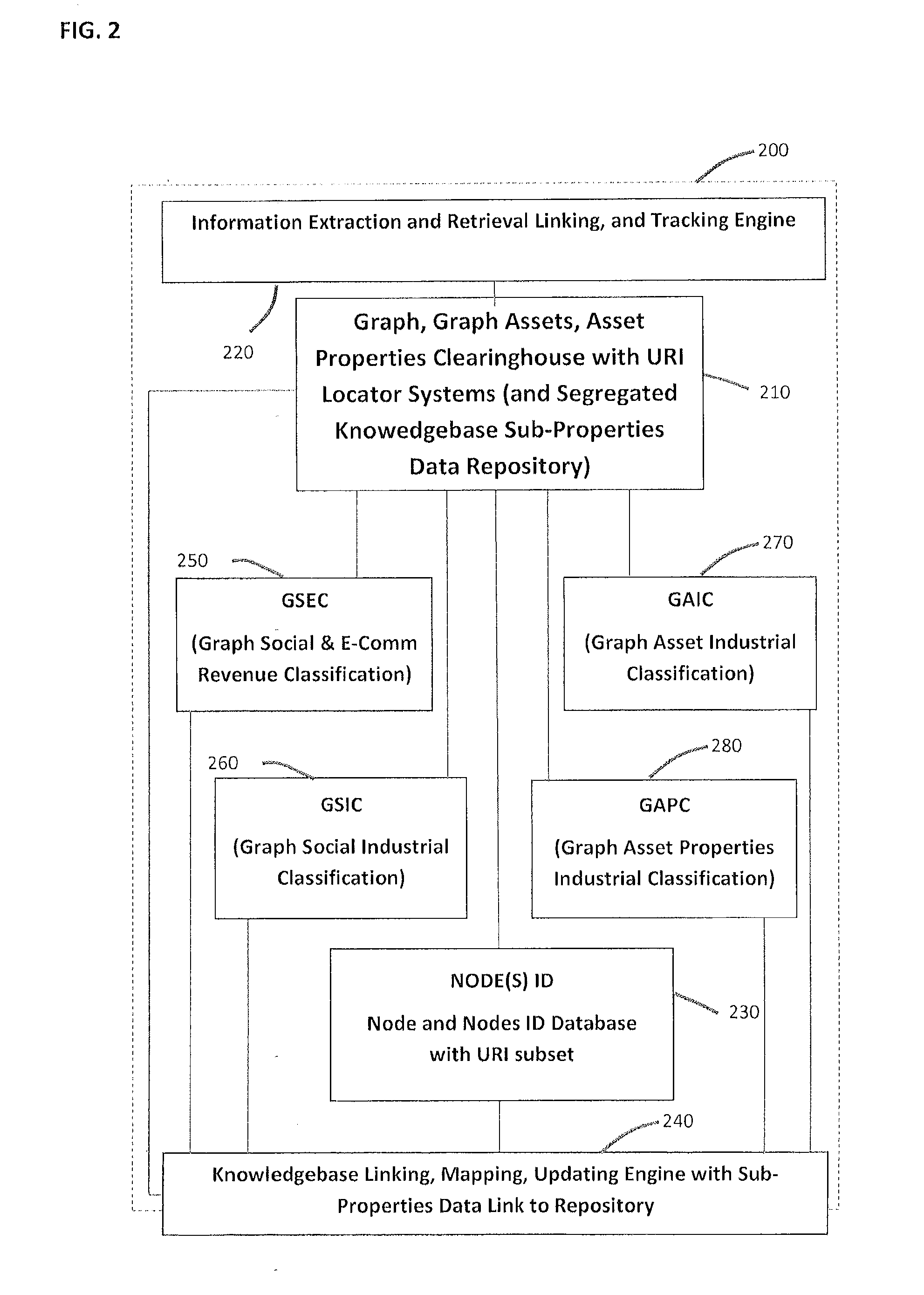

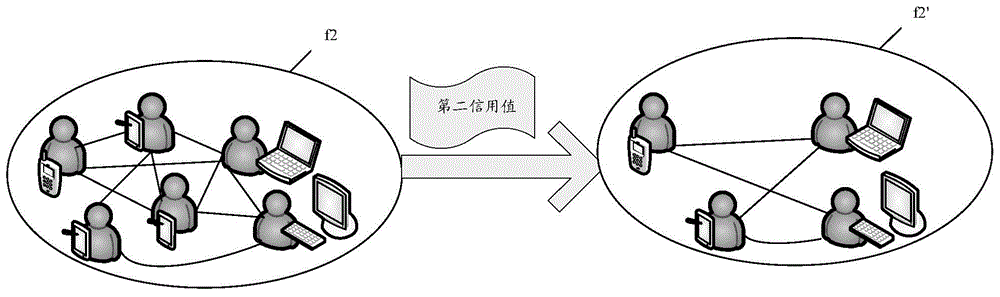

System and method for social graph and graph assets valuation and monetization

InactiveUS20130290226A1Digital computer detailsKnowledge representationReal time analysisContent analytics

A system and method to provide social and graph credit scoring, valuation and monetization. The valuation and monetization system provides users, service providers and other agents with a credit scoring and rating system. An application programming interface provides a platform for integration of all types of financial, business and personal services into the logic and classification infrastructure. A graph assets and collateralization clearinghouse creates a secure platform for collateralization. The graph assets information database provides core classification services for ranking, indexing, and content analysis. In a specific embodiment a financial services provider utilizes the social credit scoring, valuation and monetization platform to process and approve qualified credit line applicants. Approval is primarily based on graph and valuation metrics provided by the system and includes an e-commerce and social metrics real time analysis for knowledge of an applicant's future and present risk profile, including credit and graph properties risks.

Owner:DOKKEN MAYNARD

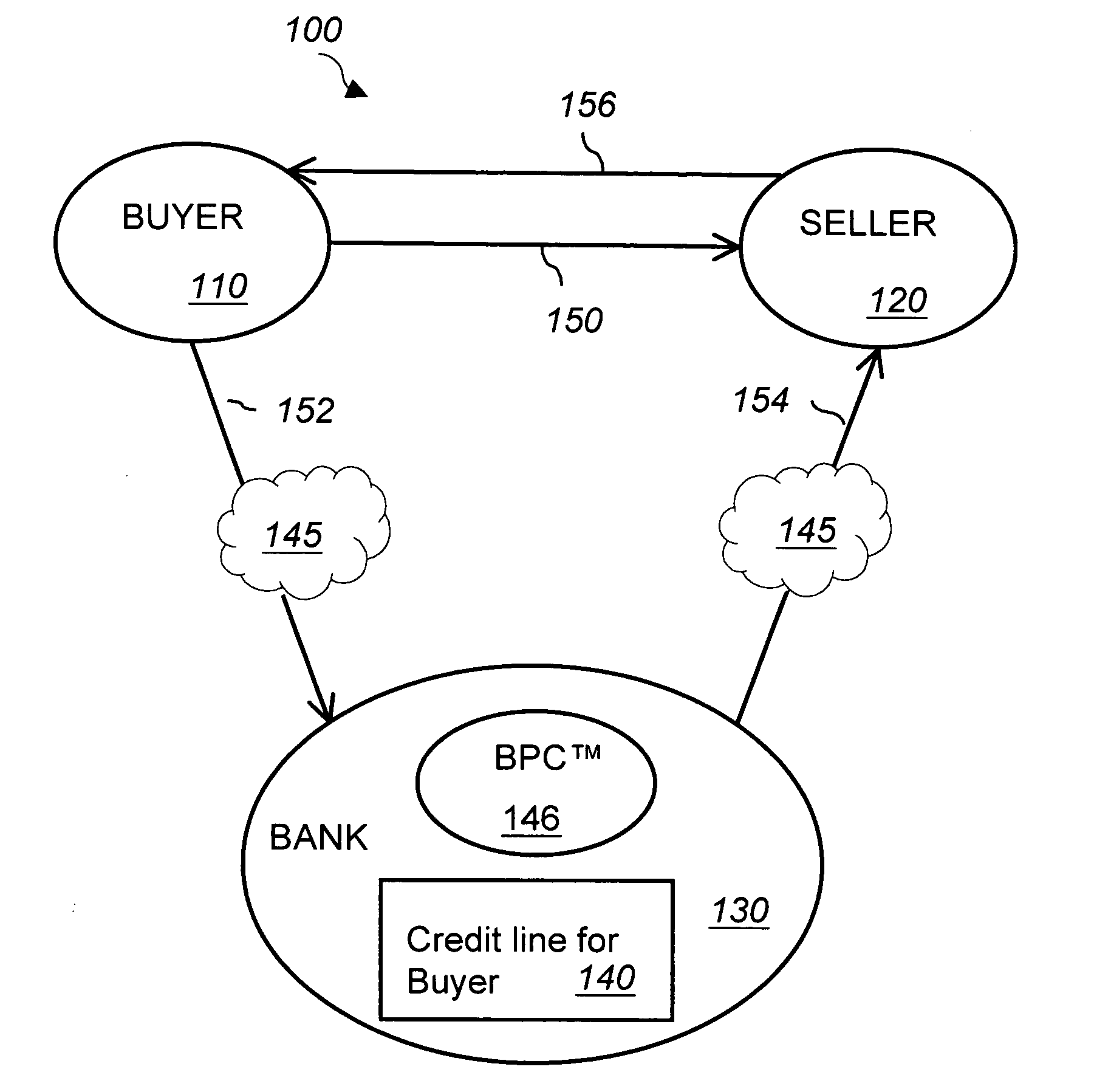

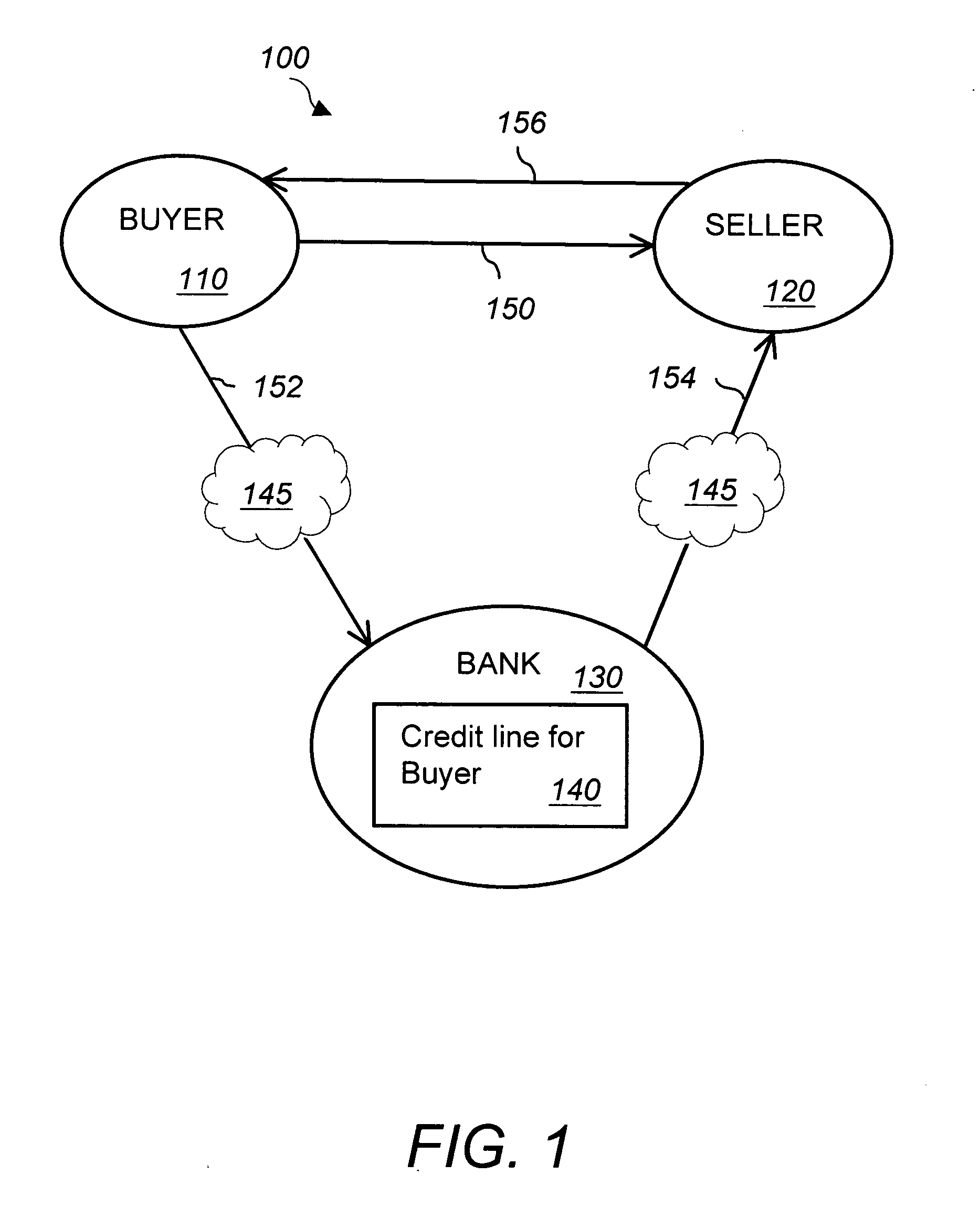

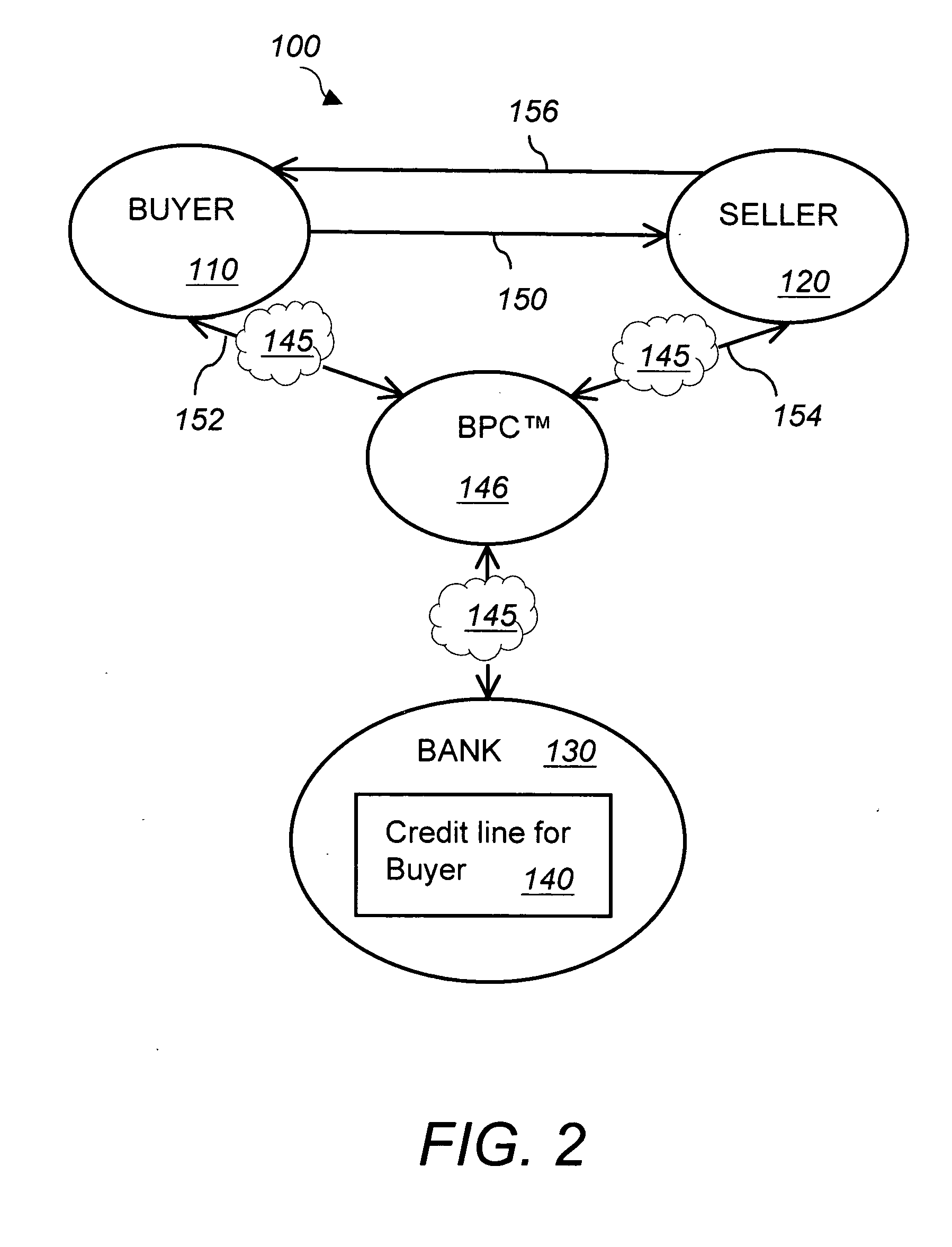

System and method for a business payment connection

InactiveUS20050027654A1Improve developmentExposure was also limitedFinancePayment architectureNetwork connectionInvoice

An online business payment method that provides credit and cash flow management for at least one seller of products or services, at least one buyer of the products or services, and a financial institution via a business payment system accessible via a network connection. The method includes first establishing a credit line for the buyer by the financial institution. Next, placing a purchase order for a product or service by the buyer to the seller and entering a purchase order number into the business payment system. Next, accepting the purchase order by the seller and providing the product or service to the buyer. Next, sending an invoice by the seller to the buyer and entering the invoice into the business payment system against the purchase order number. Next, approving the invoice by the buyer, entering the approval into the business payment system and notifying the financial institution of the approved invoice by the business payment system. Finally, approving payment of the approved invoice by the financial institution and paying the invoice by transferring money from the buyer's credit line to an account of the seller. The seller sets a payment term for the invoice and pays a seller's fee to the financial institution upon receipt of the invoice payment. The seller's fee depends upon the invoice payment term. The buyer pays interest to the financial institution when the invoice payment term is not met. Access to the online business payment system is secure and selective access permissions are defined for each member.

Owner:ADRIAN ALEXANDRA J

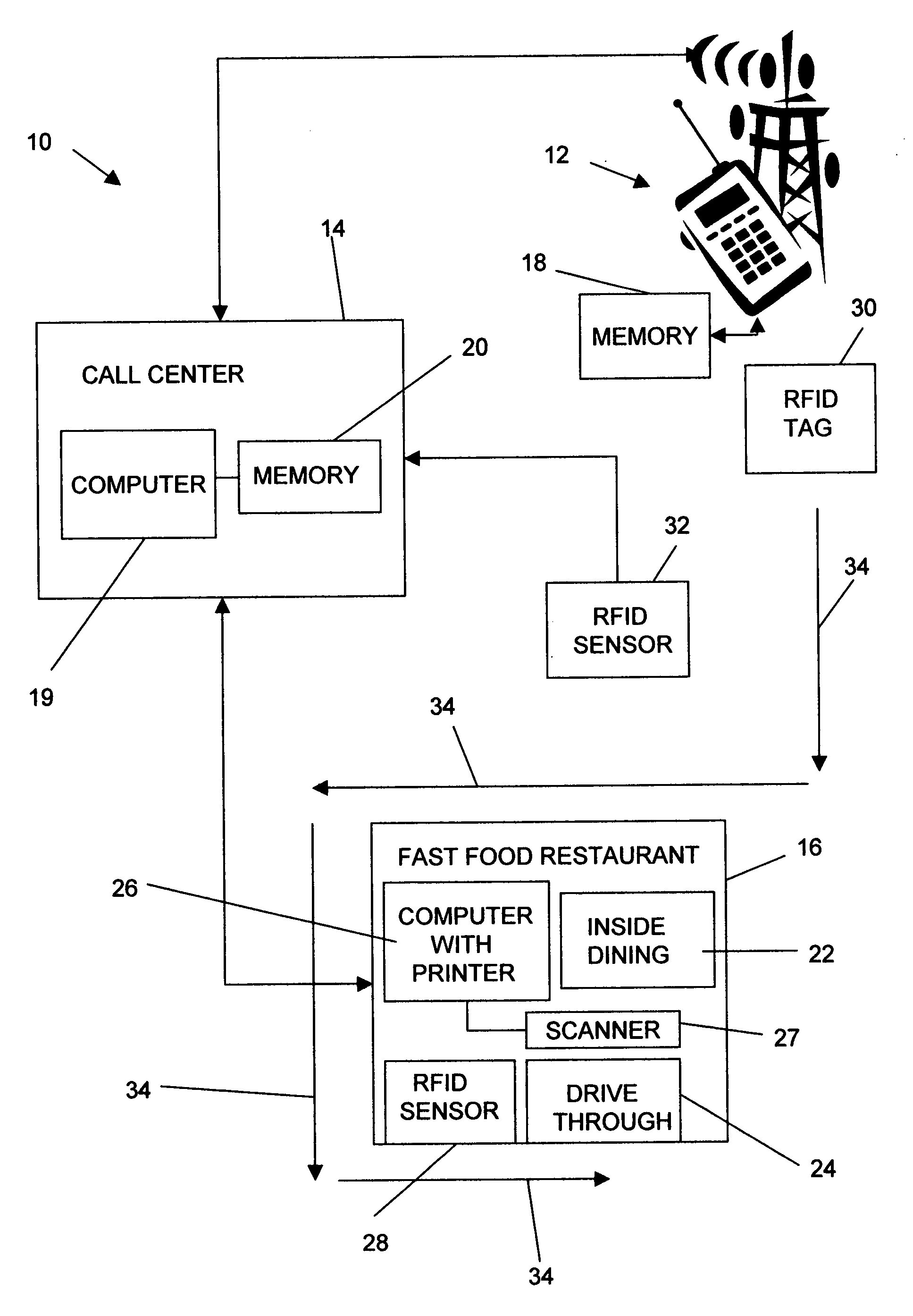

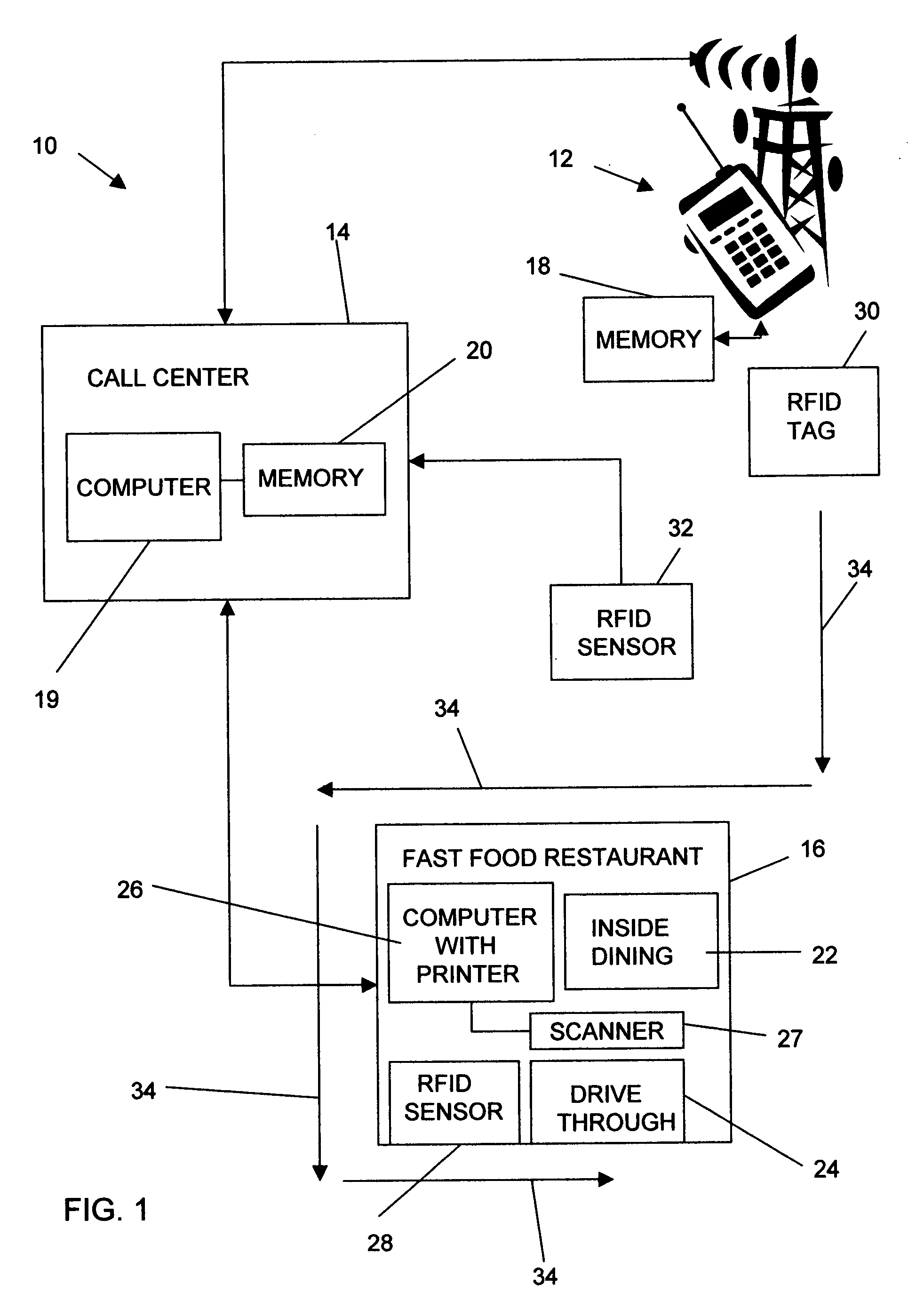

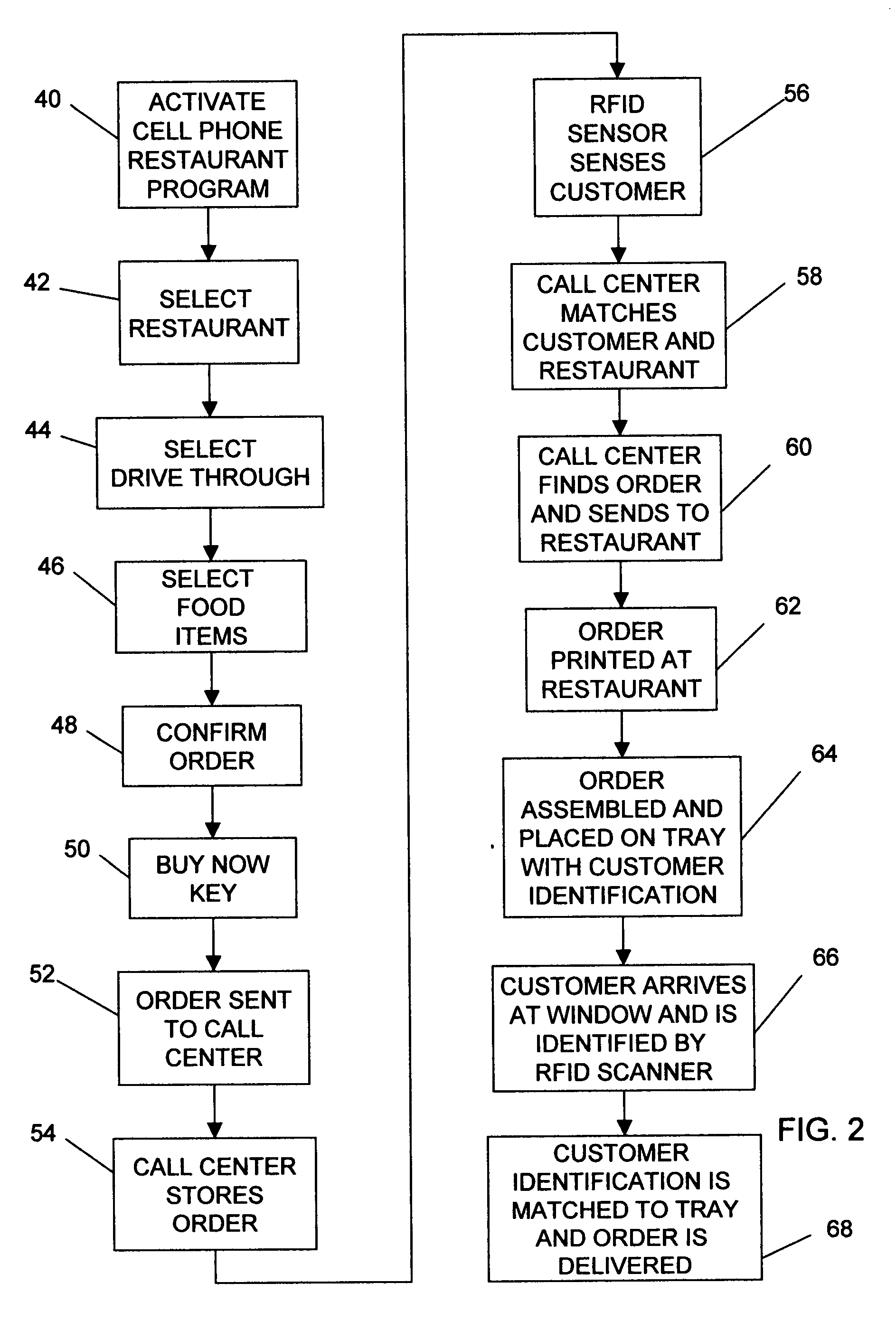

Merchandise ordering system using a cell phone

InactiveUS20070205278A1Visual presentationBuying/selling/leasing transactionsCellular telephoneComputer science

A merchandise ordering system utilizing a cell phone for communicating order information and a Radio Frequency Identification (RFID) device for customer location and identification. Orders are placed using the cell phone prior to arrival at the retail establishment. RFID customer location information indicating proximity of the customer to the retail establishment is combined with the order information to execute the order. At order pickup, the RFID information or cell phone information may be used to identify the customer for delivery of the order. An automated call center may handle multiple retail establishments or multiple chains of retail establishments. A method is disclosed for placing orders using a block of phone numbers. In one embodiment, computer controlled order delivery trays are used to match the orders with the RFID tag supplied identification and deliver the order to the customer. When the order is delivered to the customer, the customer's credit card, debit card, or credit line may be charged according to prearrangements.

Owner:LOVETT ROBERT

System and Method for Establishing or Modifying an Account With User Selectable Terms

ActiveUS20070118470A1Easy to customizeImprove satisfactionFinancePayment architectureIssuing bankService provision

The present invention relates to methods for allowing an account holder to easily customize the terms of an account such as a loan account, an asset account, a mortgage account, an insurance account, or a brokerage account. Exemplary embodiments of the invention allow the user to specify various preferred terms such as cost (e.g., APR and annual fee), rewards programs, card design, affiliates, credit line, and payment due date, among others. The financial service provider issuing the account, e.g., the issuing bank, may make the various available terms for the account easily accessible to the user, for example through an internet website or an automated phone system, enabling the user to easily specify his or her preferences. The customization methods may be applied to the process of opening a new account or customizing an existing account. The customization methods may dynamically update the available terms as the user begins to select his or her desired terms.

Owner:JPMORGAN CHASE BANK NA

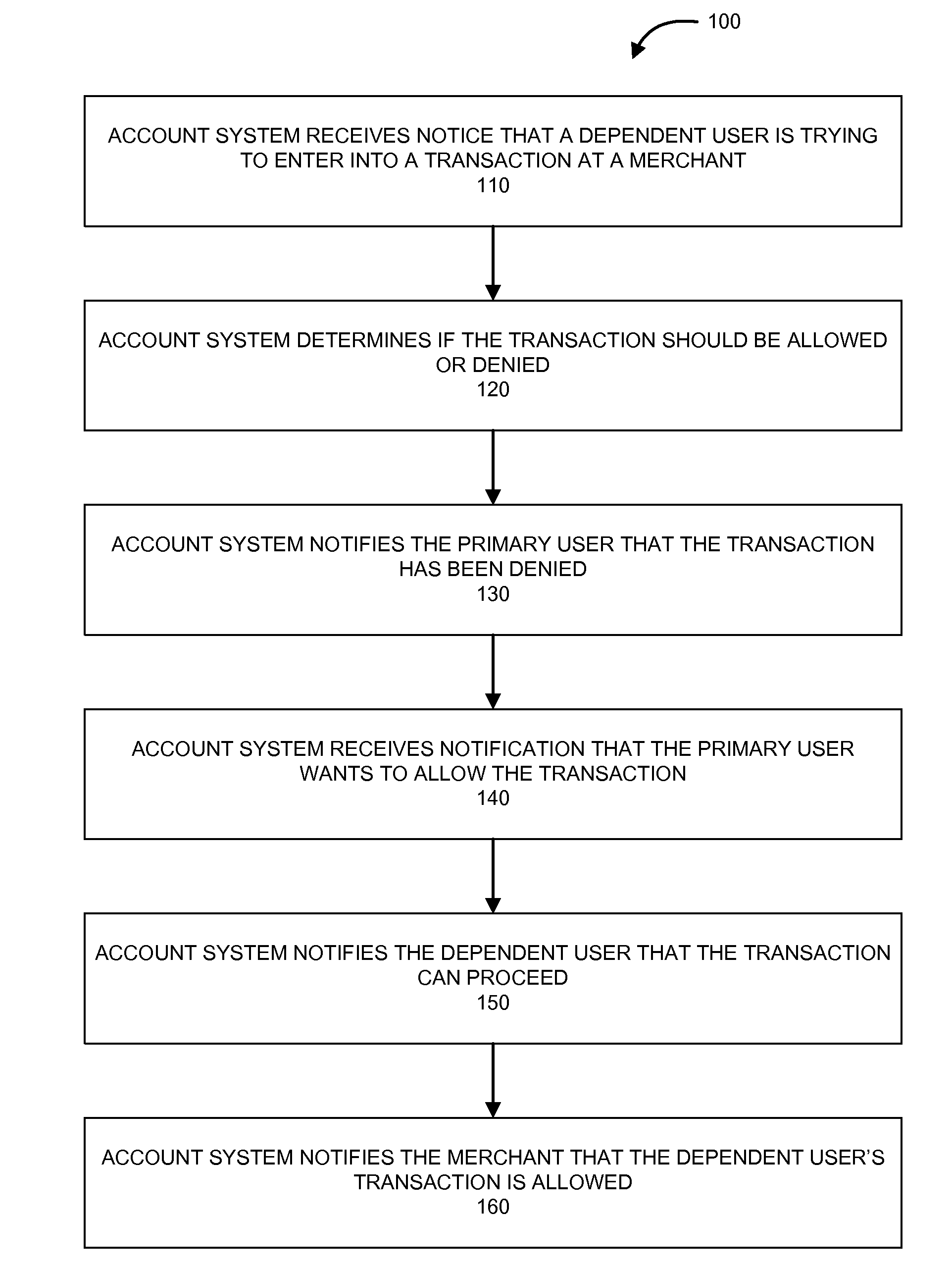

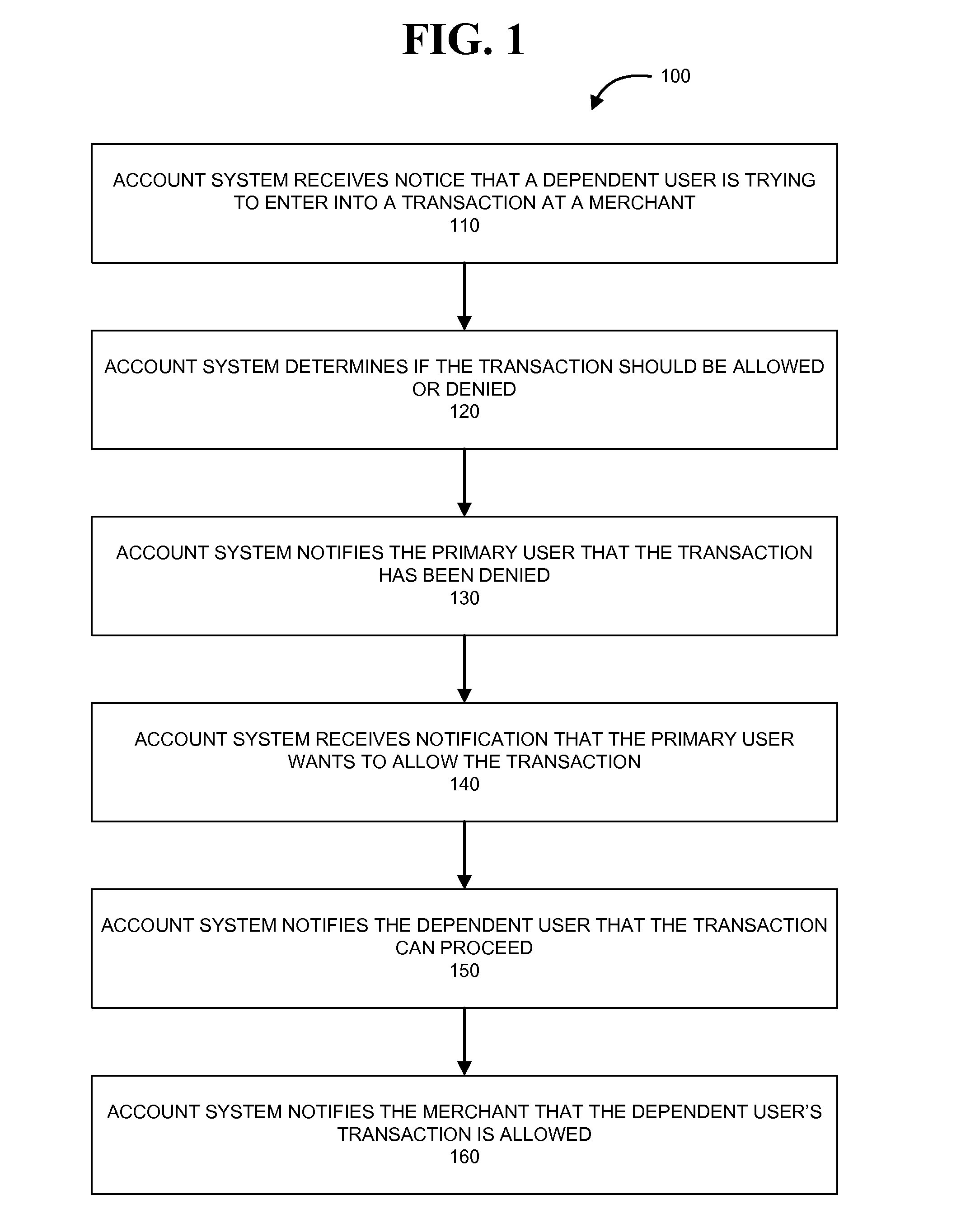

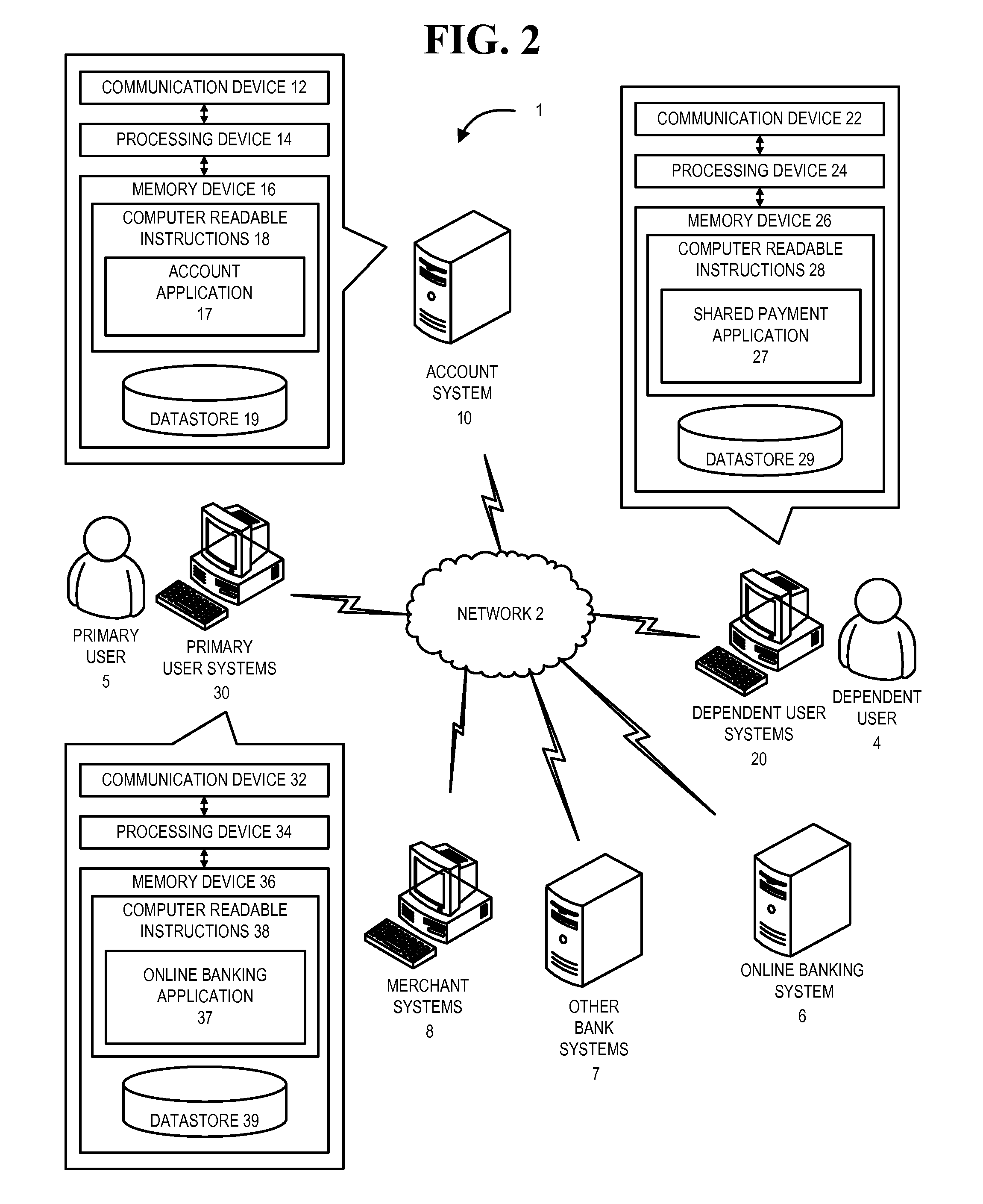

Dependent notification alert

InactiveUS20120197793A1Transaction were limitedFinanceProtocol authorisationInternet privacyCredit line

Embodiments of the invention allow a primary user to add dependent users to one or more accounts (e.g., shared accounts) of the primary user, in order to control and monitor the transactions made by a dependent user who is authorized to make purchases using the user computer systems that are linked to the primary user's shared account. The shared account can be a credit account, a debit account, a credit line account, a pre-paid account, or any other type of account that can be used to pay for products. In other embodiments of the invention the primary user may be linked to the dependent user account, be it a shared account or the dependent user's own account, in order to receive notification alerts regarding the transactions that the dependent user is trying to make.

Owner:BANK OF AMERICA CORP

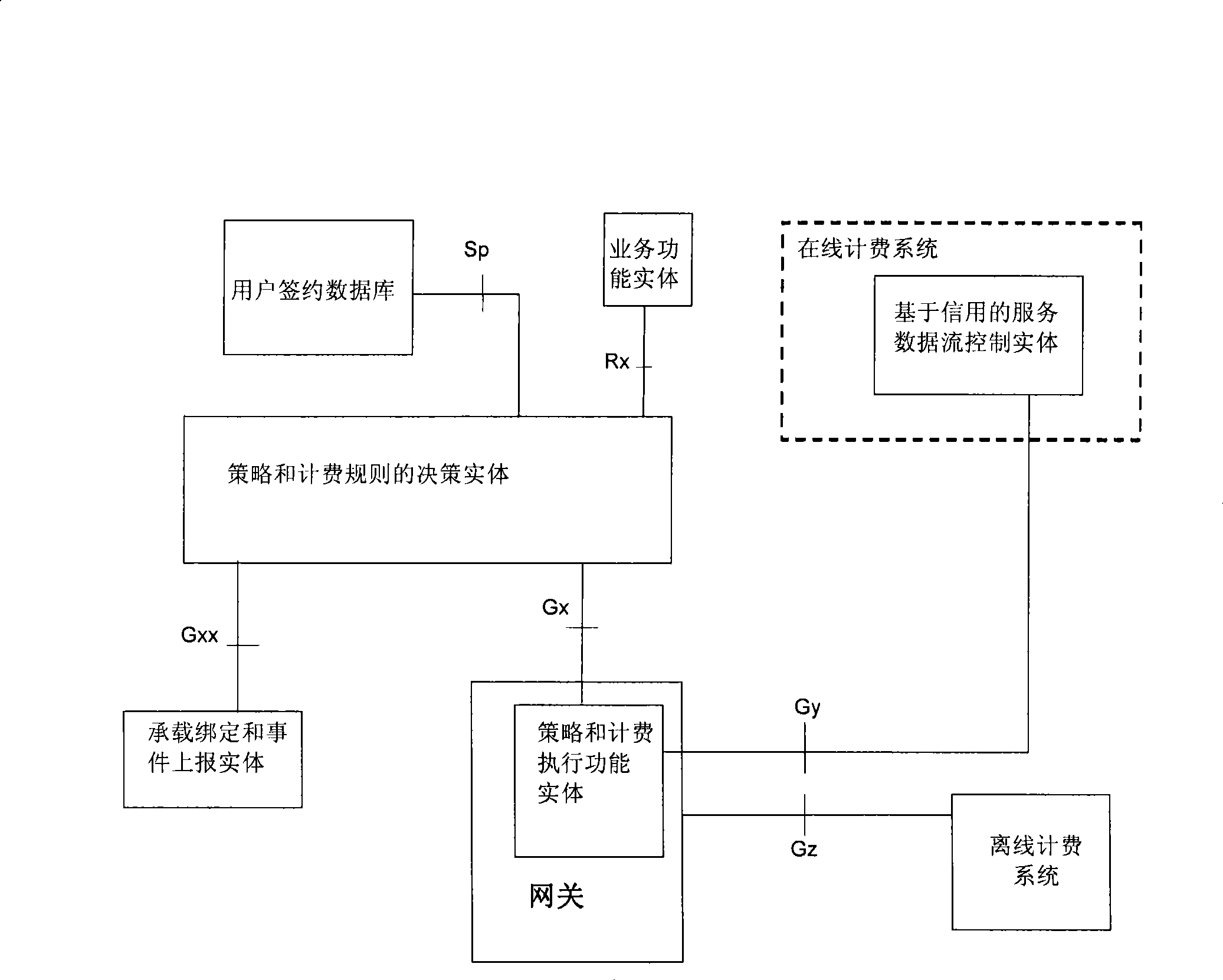

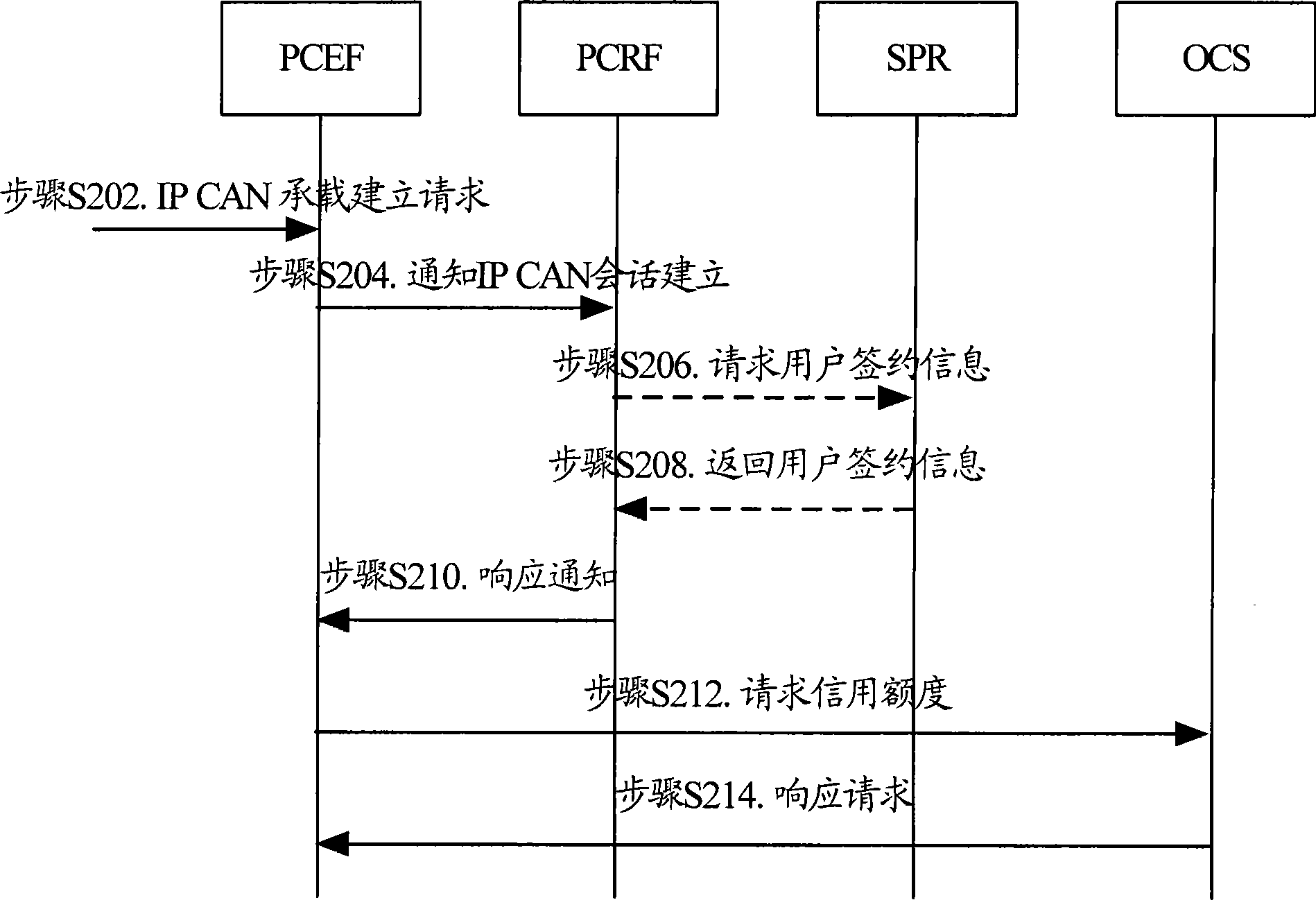

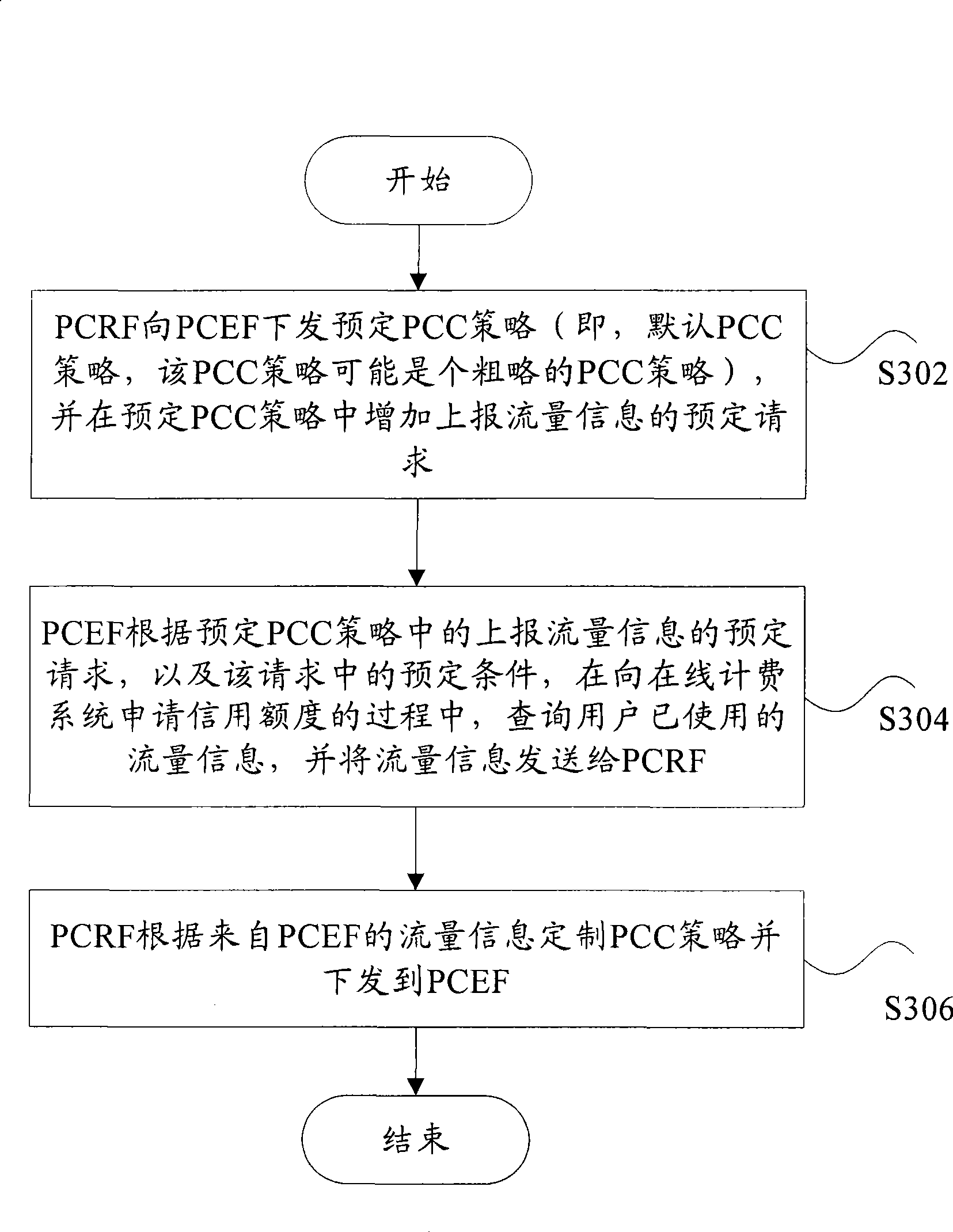

Policy and charging control method and system

InactiveCN101431420ASolve usabilityTroubleshoot billing rulesMetering/charging/biilling arrangementsAccounting/billing servicesCharge controlData mining

The present invention discloses a strategy, accounting control method and a system, wherein the method comprises the following procedures: sending down reservation strategy and accounting control PCC strategy to strategy and accounting executing function entity PCEF by strategy and accounting rule decision-making entity PCRF, and adding reservation request of flow information to be reported in reservation PCC strategy; searching flow information and transmitting flow information to PCRF while applying credit line to online accounting system according to reservation request of report flow information in reservation PCC strategy by PCEF, wherein flow information means used flow by user; making PCC strategy and transmitting it down to PCEF according to flow information from PCEF by PCRF. The method according to the invention can make strategy based on user flow information by PCRF.

Owner:ZTE CORP

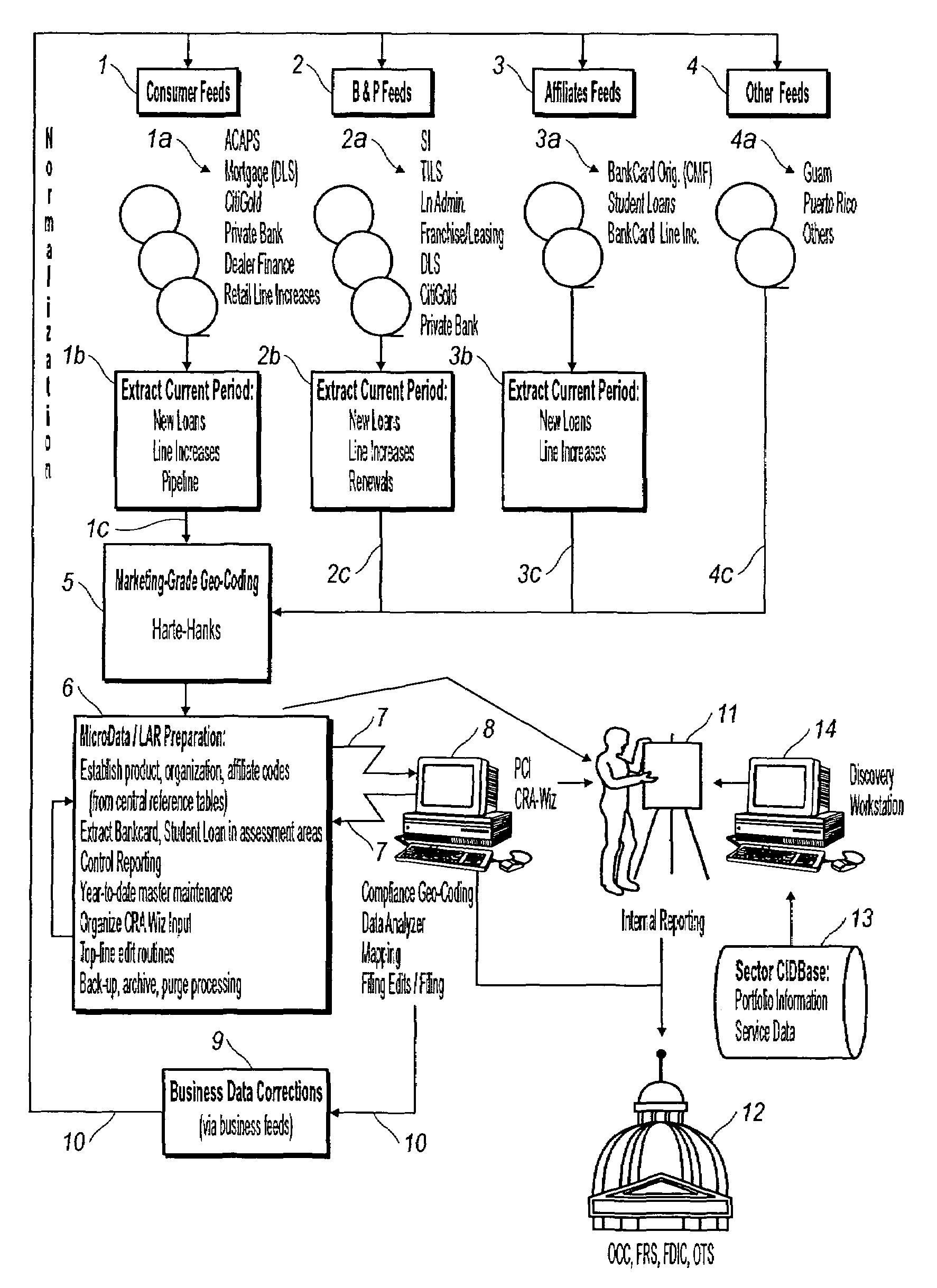

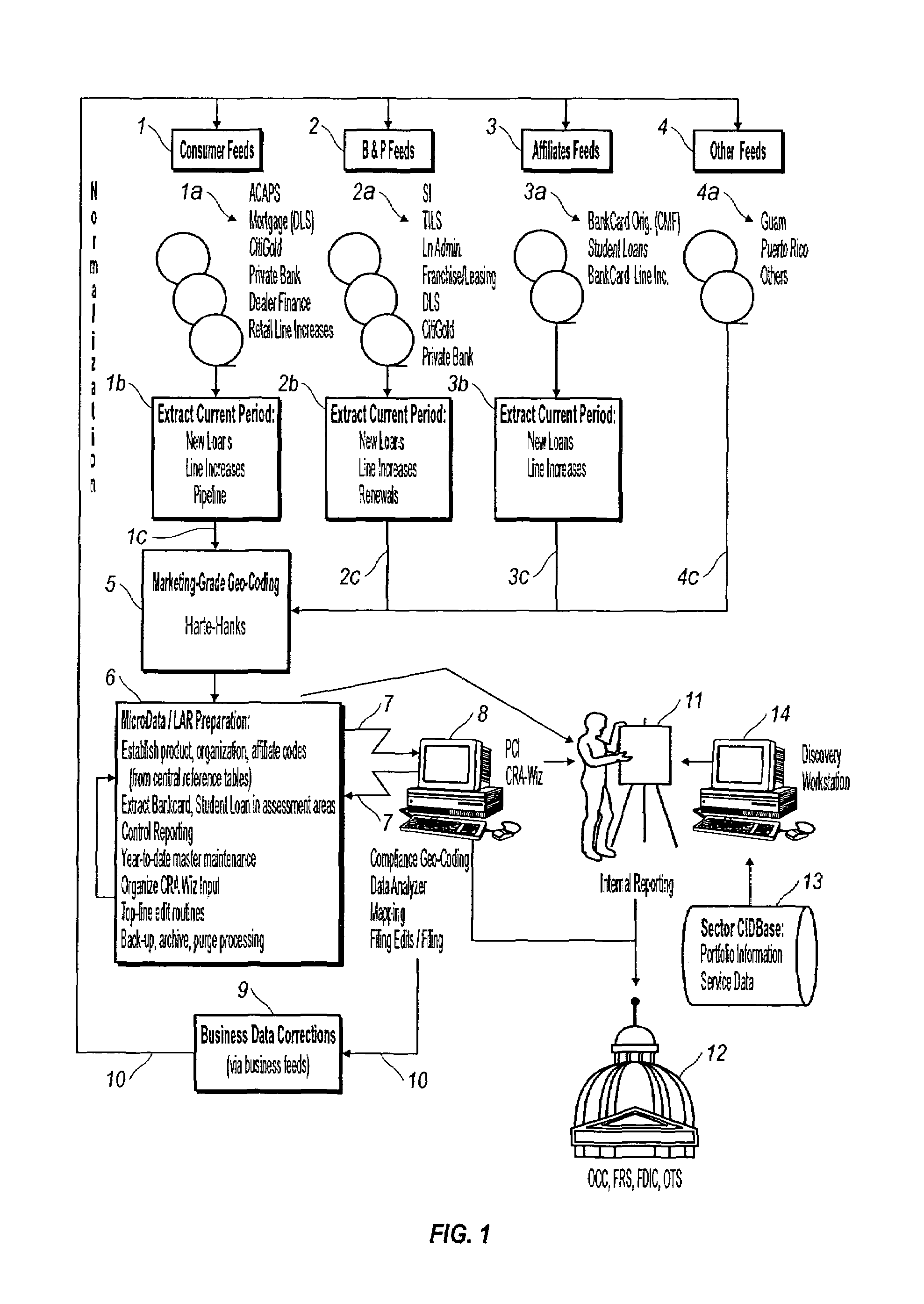

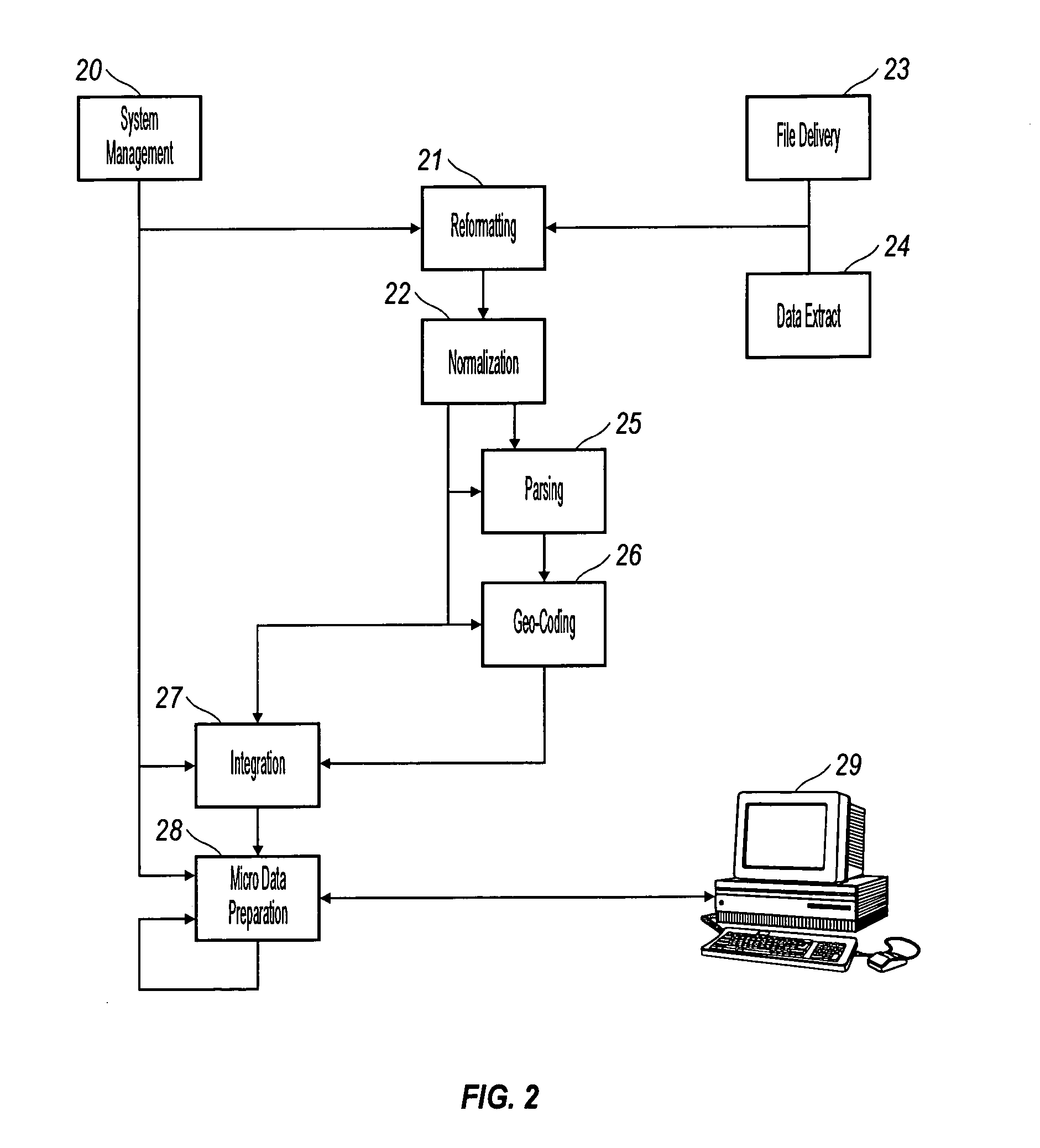

Method and system for performing CRA, HMDA, and fair lending analysis and reporting for a financial institution

InactiveUS6993505B1Solve the real problemAvoid restrictionsFinanceSpecial data processing applicationsNot for profitCredit card

The present invention discloses a method and system for collecting, standardizing, and analyzing lending data from all the offices of a financial institution, including information on small business, home equity, motor vehicle, credit card, mortgage, other secured and unsecured consumer products for commercial, community development, not-for-profit, and consortium customers. The invention enables data collection and analysis in a timely fashion such that interim reports may be prepared so that changes in lending practices can be implemented to assist with assuring compliance with the fair lending acts. A central repository is linked to all of the offices of the financial institution, and data mapping features are used to provide standardized reporting so that all data will be reported in a standardized form. The system processes, collects and standardizes information on new loans, renewals, credit line increases and application decisions for all of the business units within a financial institution. The present invention permits internal management reporting for review of performances against the CRA and HMDA plans. It also permits preparation of the reports for filing with the federal regulatory agencies, such as OCC, FRS and OTS. Furthermore, the present invention permits rapid response to federal regulatory agency audits of reported CRA and HMDA information.

Owner:CITIBANK

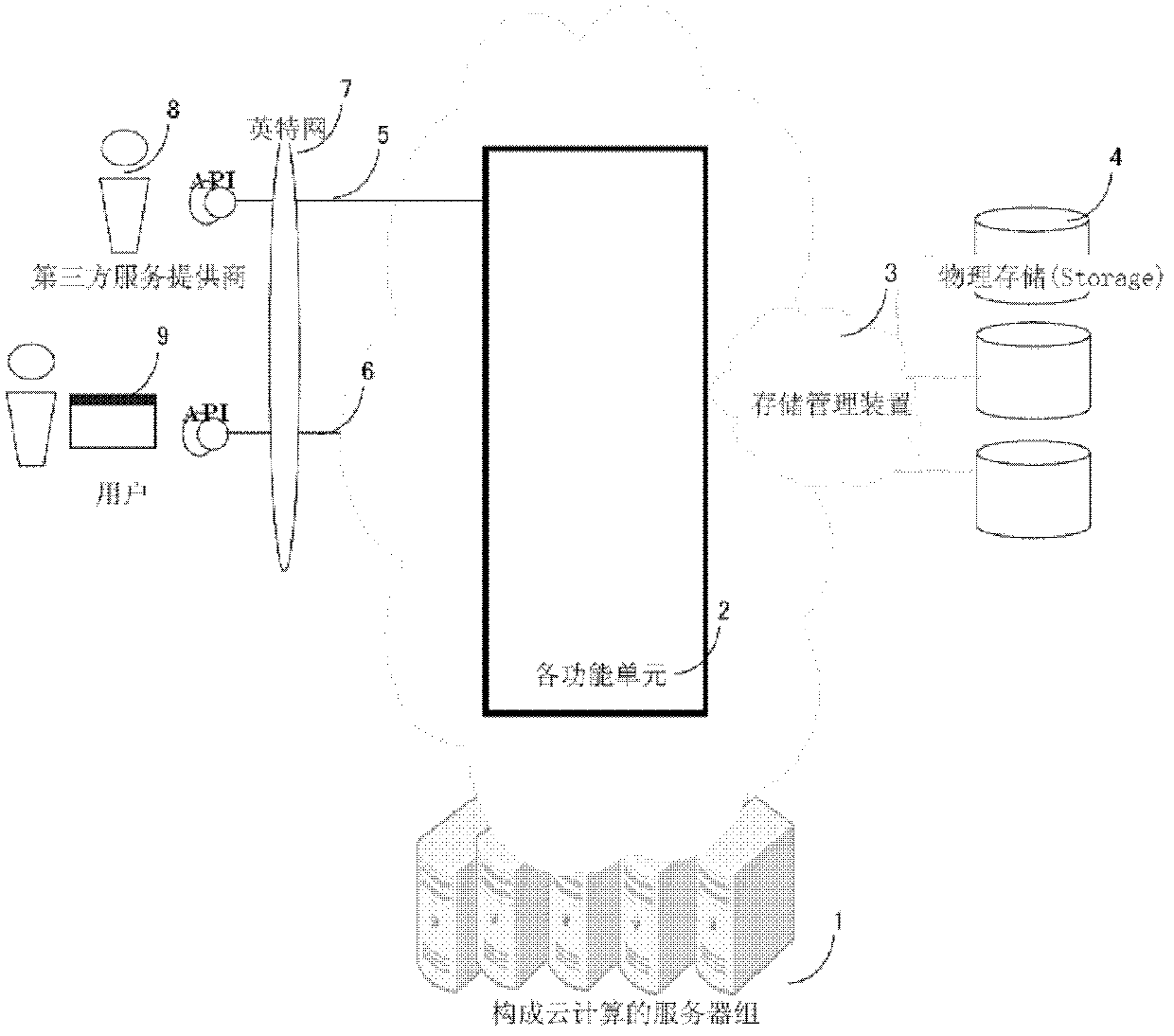

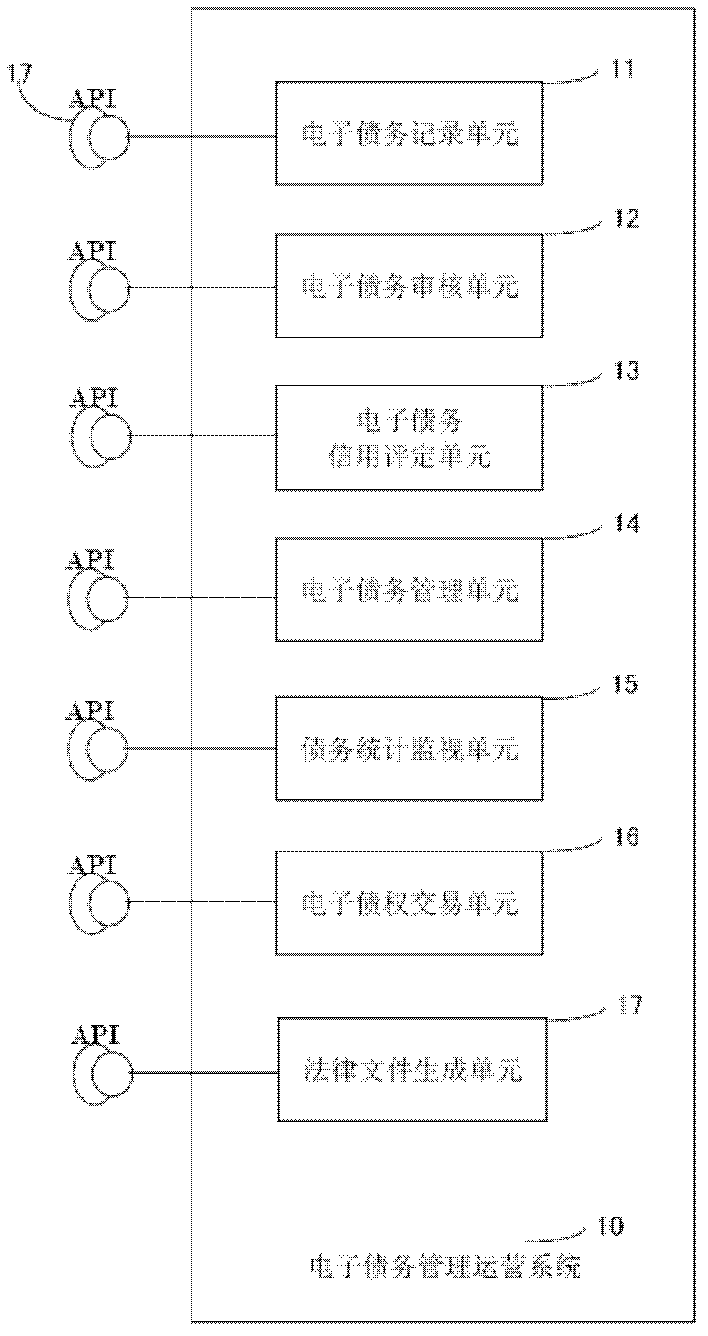

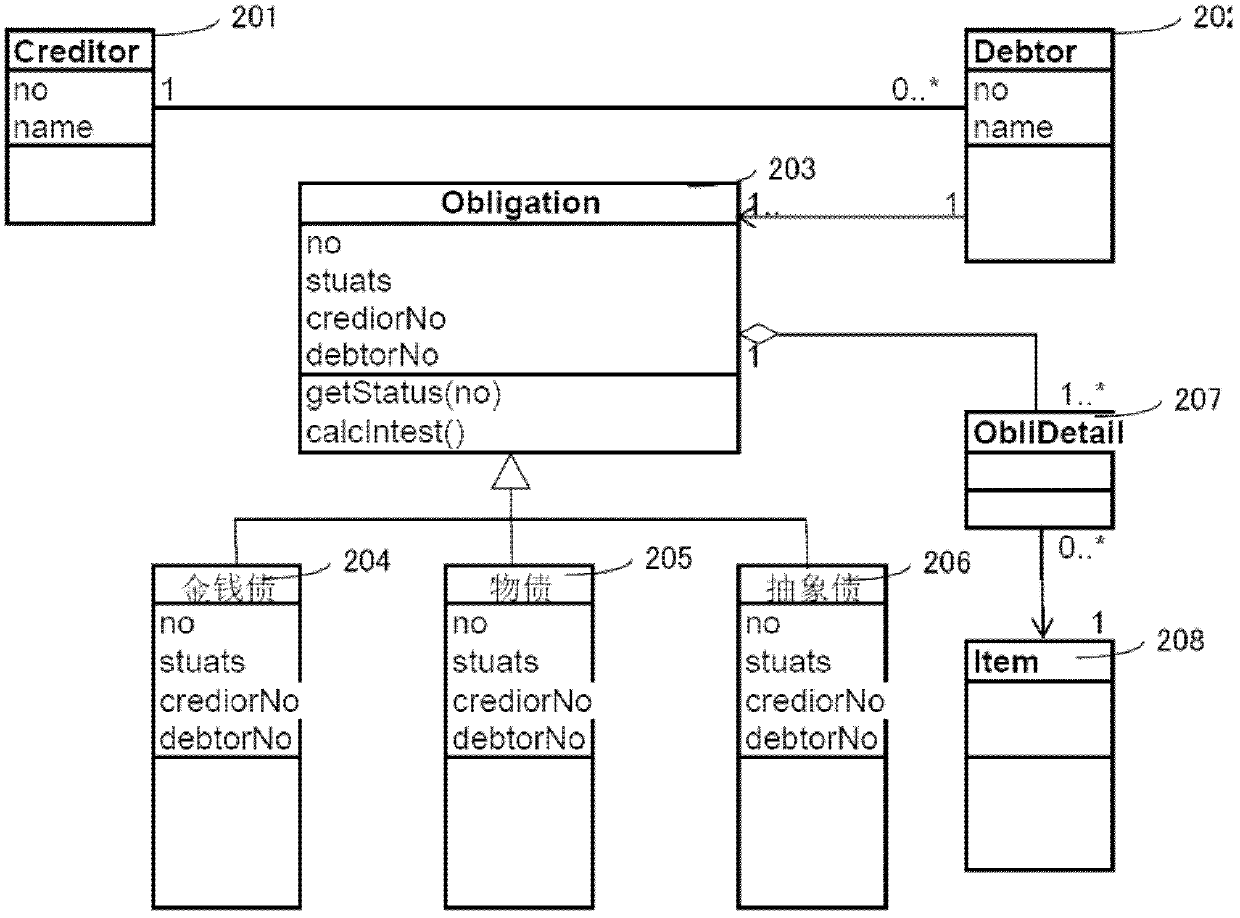

Electronic debt management operation system device and realization method of electronization and financial commercialization of claim and debt

InactiveCN102243748ASignificantly progressiveFlexible and softFinanceCommerceThird partyData interface

The invention discloses a method for realizing debt generation, recording and management implementation of money and others except money through a network electronic way and a system device, which are used for making clear the claim and debt relationship of the traditional agreement according to law, monitoring the implementation of the managed debt, and providing a data interface converting the managed electronic claim into financial instrument, wherein circulation of the electronic claim can be realized on a third-party transaction platform through the data interface, or automatic clearing of chain debt can be realized in system. The device and method disclosed by the invention can monitor the implementation of the managed debt, perform divided transaction by taking the debt right as financial instrument on the premise of notifying the debtor, and provide all legal evidences and certificates according to the needs of the debtor and creditor in the case of debt dispute. According to the invention, the traditional contradiction in claim and debt can be solved to increase the credit line of claim and debt, and the debt right can be converted into a transactional financial instrument.

Owner:郁晓东

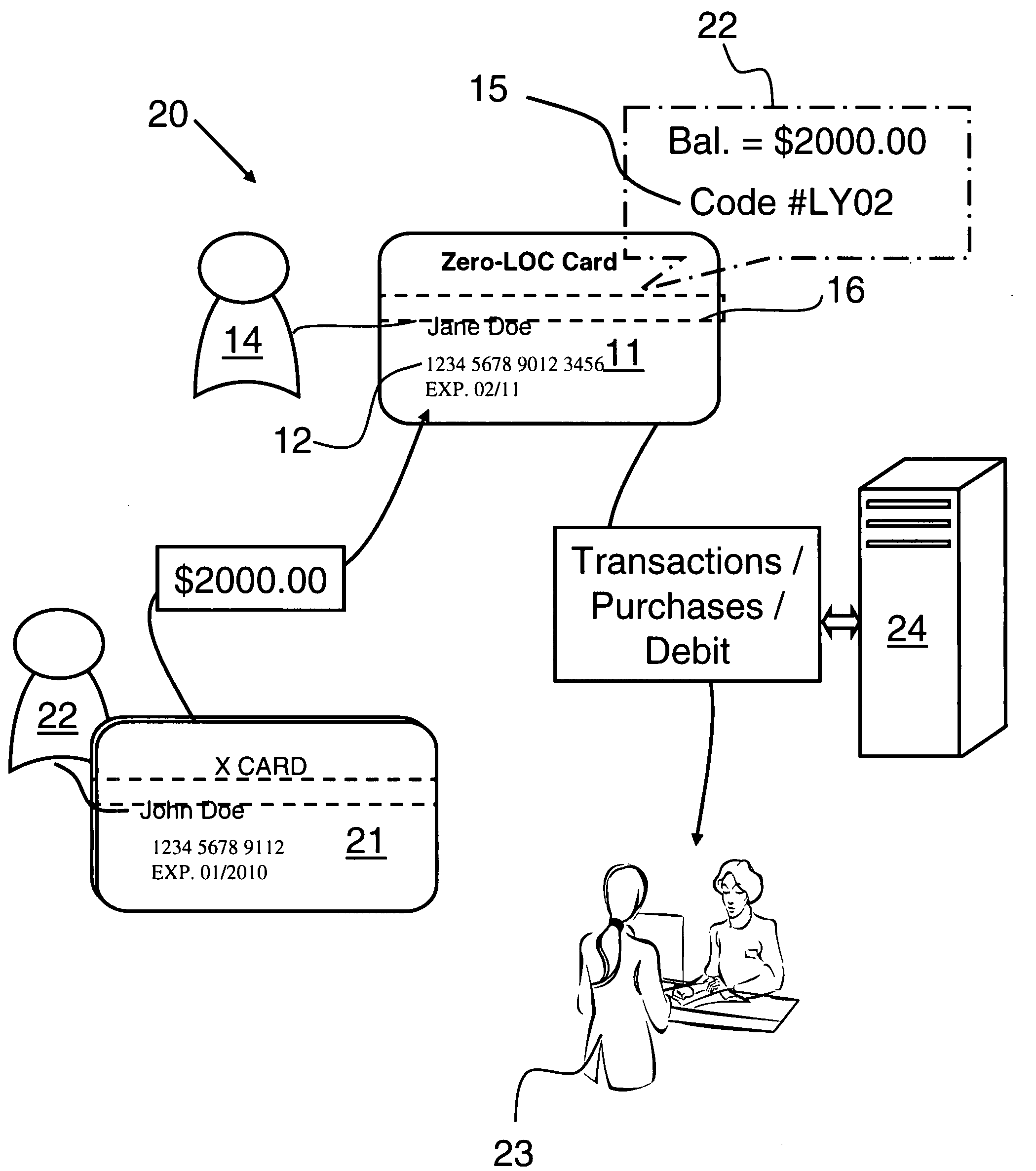

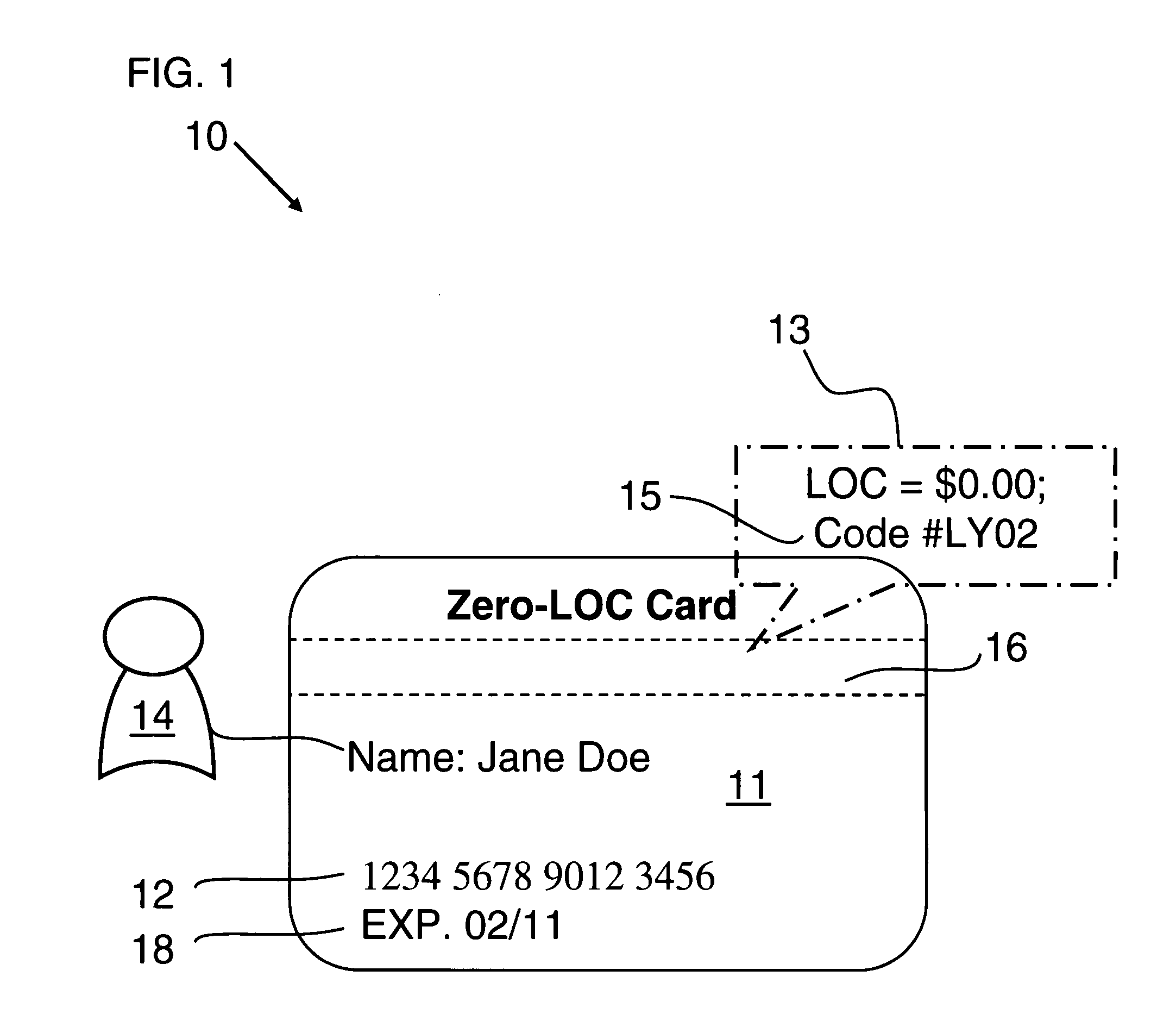

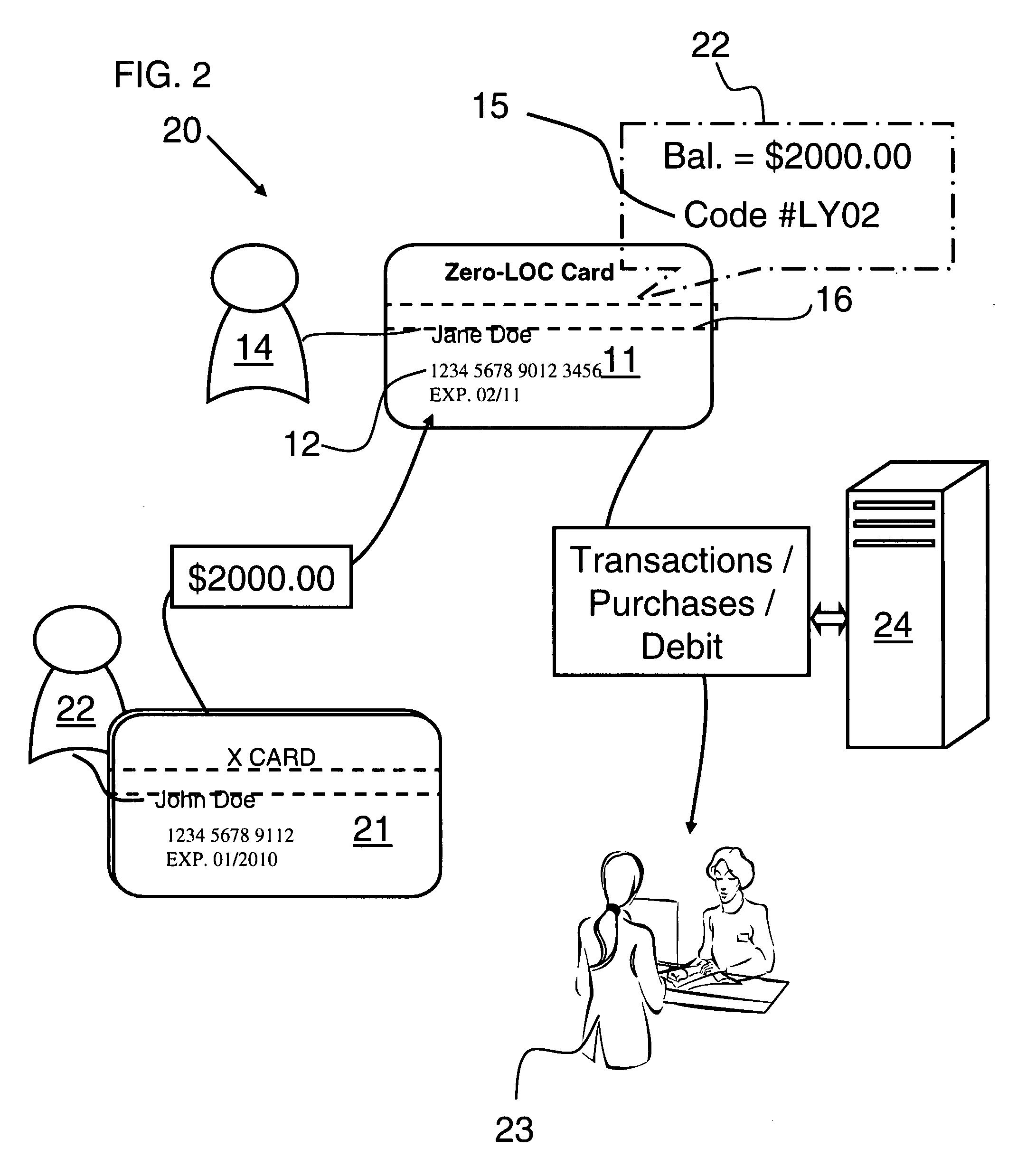

Credit card payment system and method

A credit card payment system and method includes a zero-LOC card having a unique identification number and a zero line of credit issued to an individual or a small business. The zero-LOC card is appointed to be funded by at least one transfer from a funding card account to provide a credit balance on the zero-LOC card. A sub-product code is integrated within the card system to provide restrictions or expansions to usage and function of the zero-LOC card. Storage, computing and communication means are provided. Existing cardholders allocate their assigned lines of credits in creative ways to address their individual needs. The credit card payment system allows cardholders to allocate their unused credit lines at their own expense and to the mutual benefit of consumers, small businesses, merchants and credit card issuing companies, thereby facilitating more frictionless trade and growing the economy.

Owner:SHARMA BANSI LAL

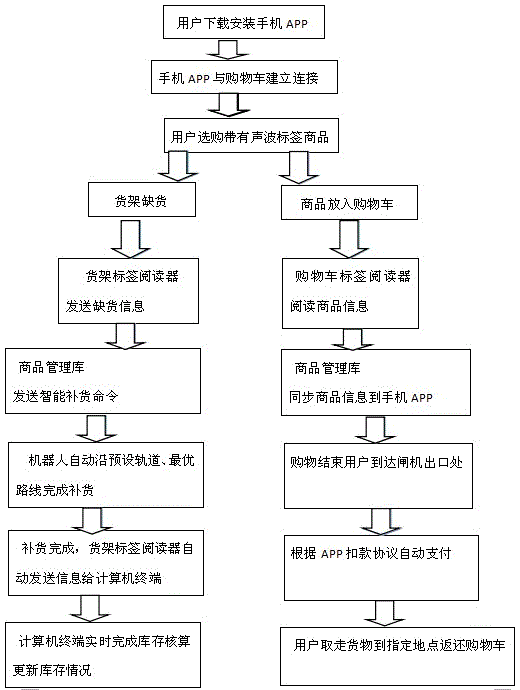

Supermarket shopping system and method based on sonic label technology

InactiveCN106097049AIncrease stickinessIncrease loyaltyCo-operative working arrangementsPayment architectureDatabase analysisPayment

The invention provides a supermarket shopping system and method based on a sonic label technology. The system comprises a supermarket goods storehouse management background, an automatic replenishment robot, a sonic label 360 degree reader shopping cart and shelf, goods with sonic labels, a computer terminal in wireless communication with the shopping cart with the label reader, a mobile phone in network connection with the computer terminal, a user shopping habit analysis database connected with the mobile phone and another computer, a cloud platform, a user APP accumulation credit library, a credit line pre-loan system, and an automatic opening and closing gate. According to the invention, goods unique code information reading and automatic robot replenishment for out-of-stock shelves are realized; simultaneous reading of the reader is not affected by overlapping stacking of goods put into the shopping cart; shopping code, amount and total amount are simultaneously displayed on a mobile phone APP; the mobile phone APP can be fixed with a bank card, or an APP credit blank note is used for overdraft payment; after payment, a gate carries out automatic identification and opening for releasing; a user database analyzes user purchase habits and many other preferred functions; and the system and method have the advantages of simple structure, reasonable design and easy manufacture.

Owner:安徽省凯乐唯物联科技有限公司

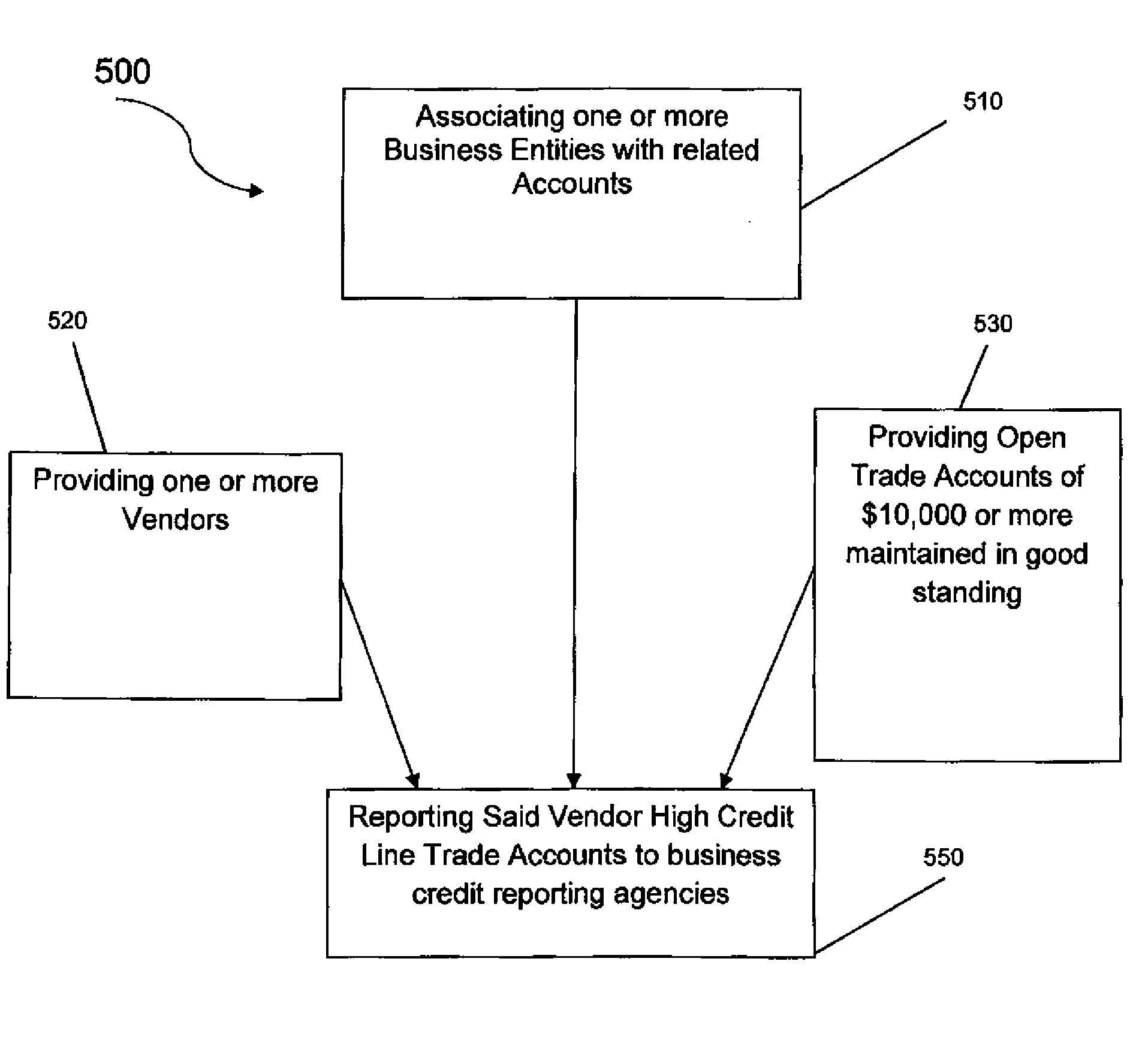

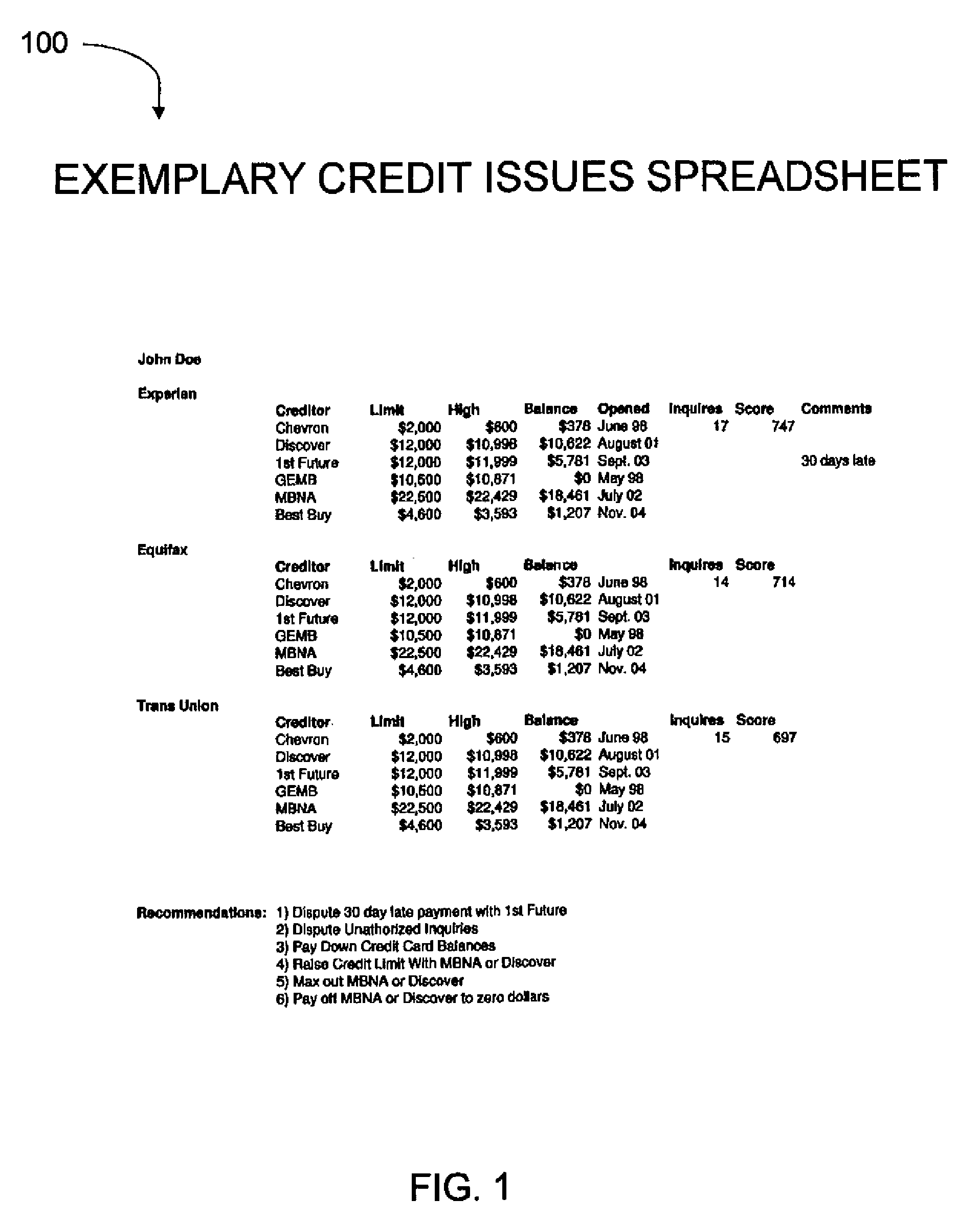

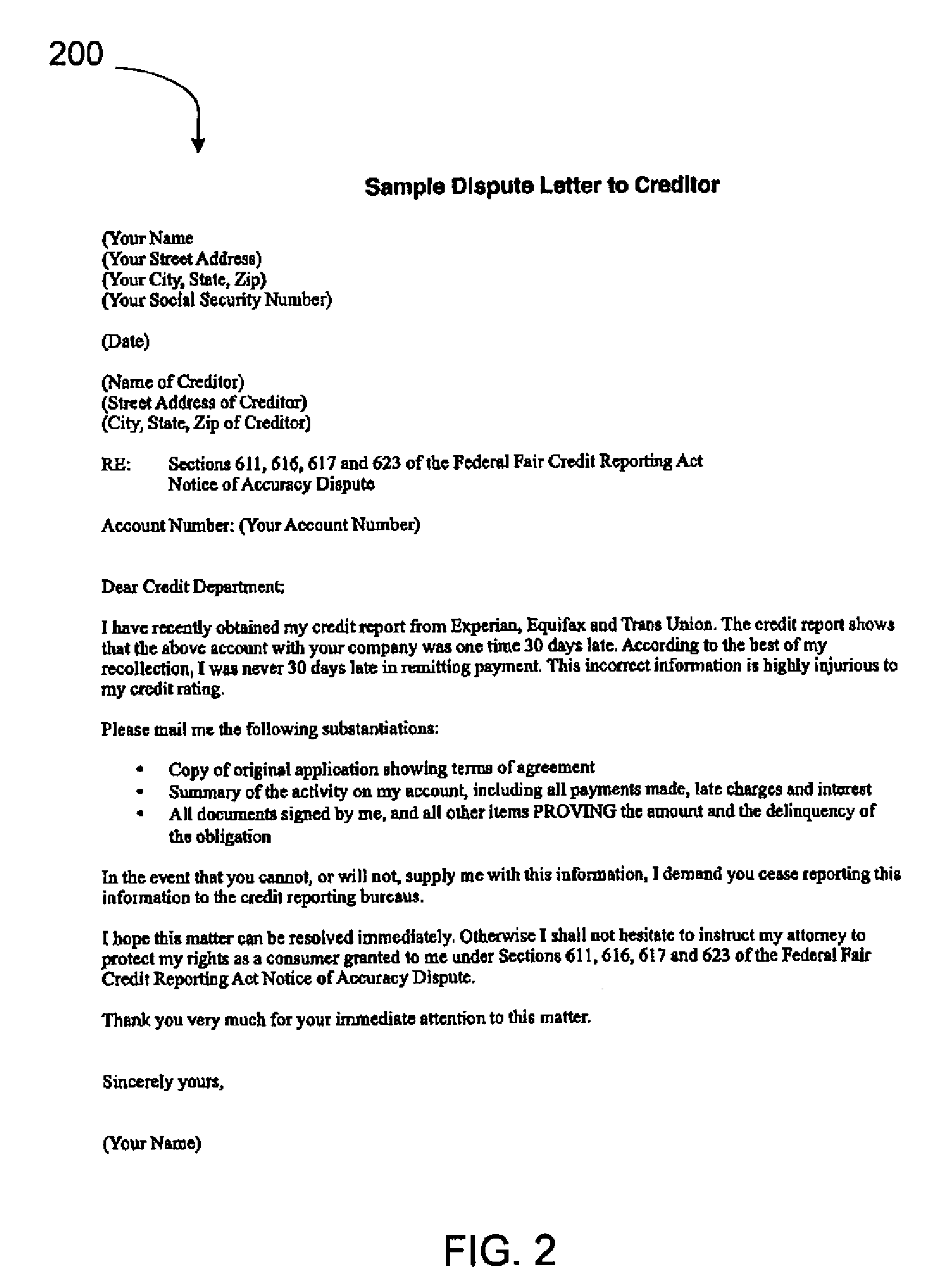

Systems and methods for establishing business credit and improving personal credit

InactiveUS20080294547A1Increasing credit scoreMaximizes positive impactFinancePayment architectureCredit systemExternal data

Systems and methods are disclosed for establishing one or more personal guarantor(s); establishing one or more business entities; establishing a professional business presence; reporting the professional business presence and the one or more personal guarantors to one or more credit scoring companies; establishing a PAYDEX score of said one or more business entities to a minimum of 80 resulting in an applicant's ability to obtain a larger credit line and at more favorable contract terms determined by one or more credit line providers reviewing external data. Another embodiment includes a method for establishing at least one high credit line credit accounts of one or more business entities with an open trade account of $10,000 or higher maintained in good standing and reporting said trade accounts(s) to the business credit scoring agencies.

Owner:ZIGMAN JEREMY

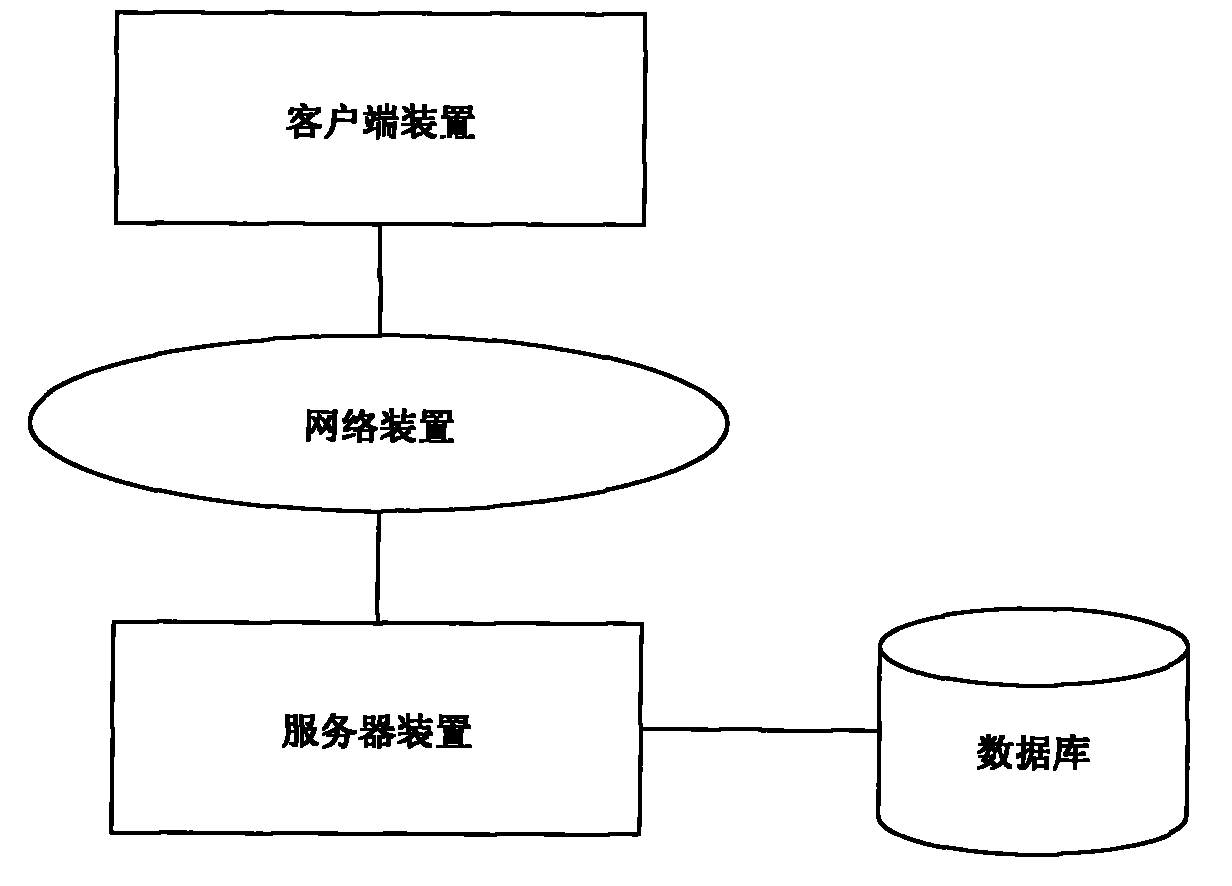

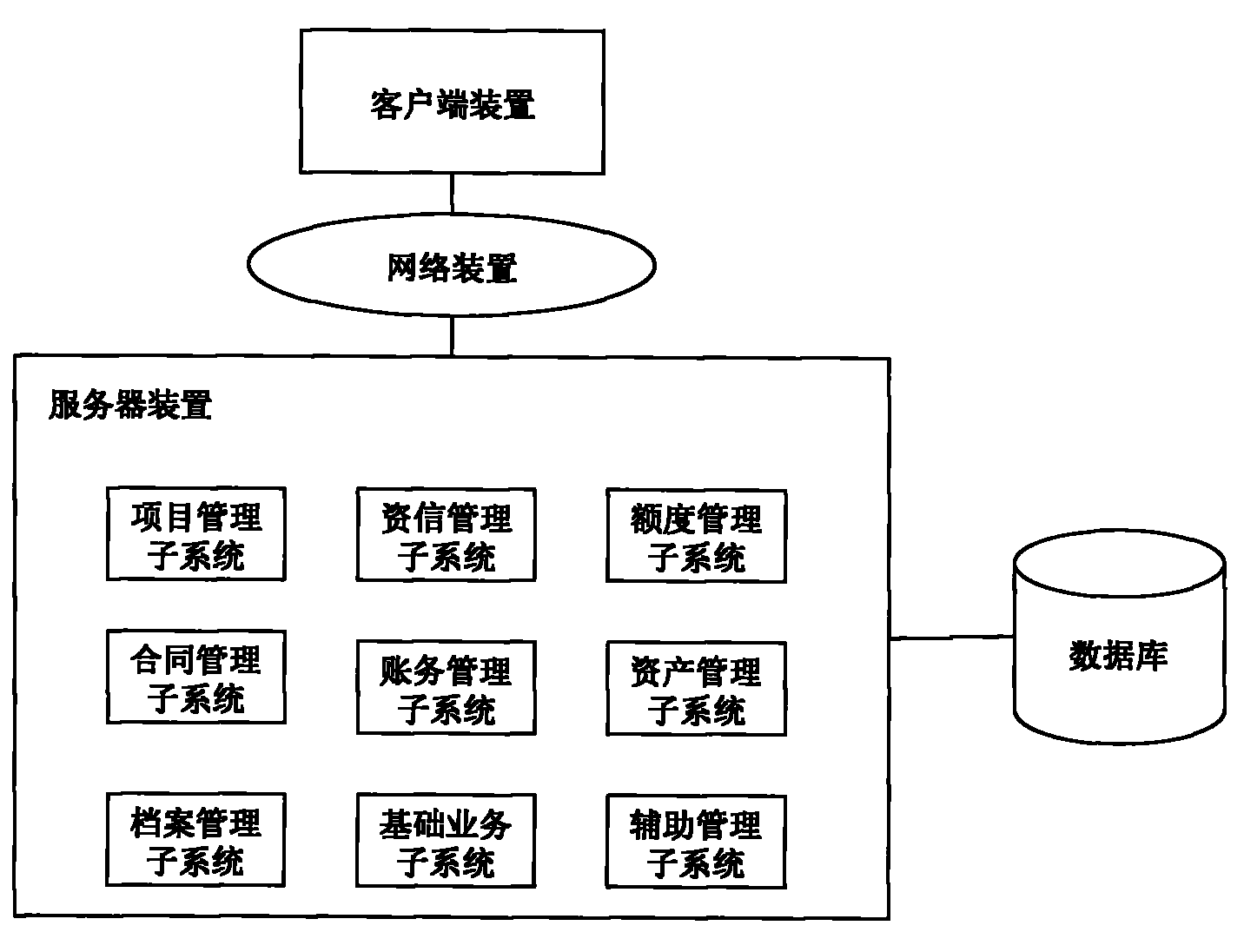

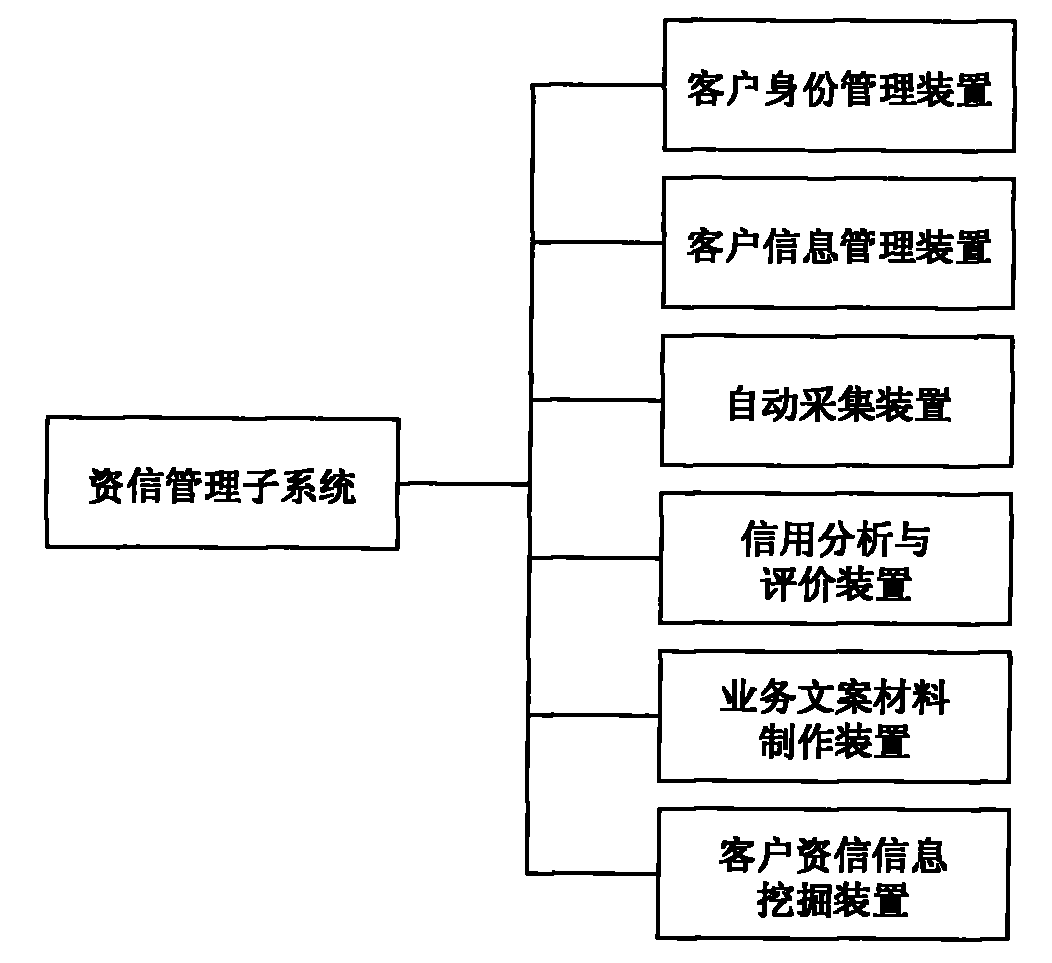

Credit levying business system

The invention provides a credit levying business system comprising a client side device, a network device, a server device, a data bus and a database, wherein the server is provided with a plurality of subsystems; each subsystem is connected to the client side device by the network device and is connected to the database via the data bus; the plurality of subsystems comprise an assistant management subsystem, an item management subsystem, a credit standing management subsystem, a credit line management subsystem, a financial management subsystem, an asset management subsystem and a file management subsystem. In the credit levying business system, an information technology means serves as a support platform, a unified process model for financing business is built, and a support frame is provided for continuously innovating the financial product.

Owner:苏州德融嘉信信用管理技术股份有限公司

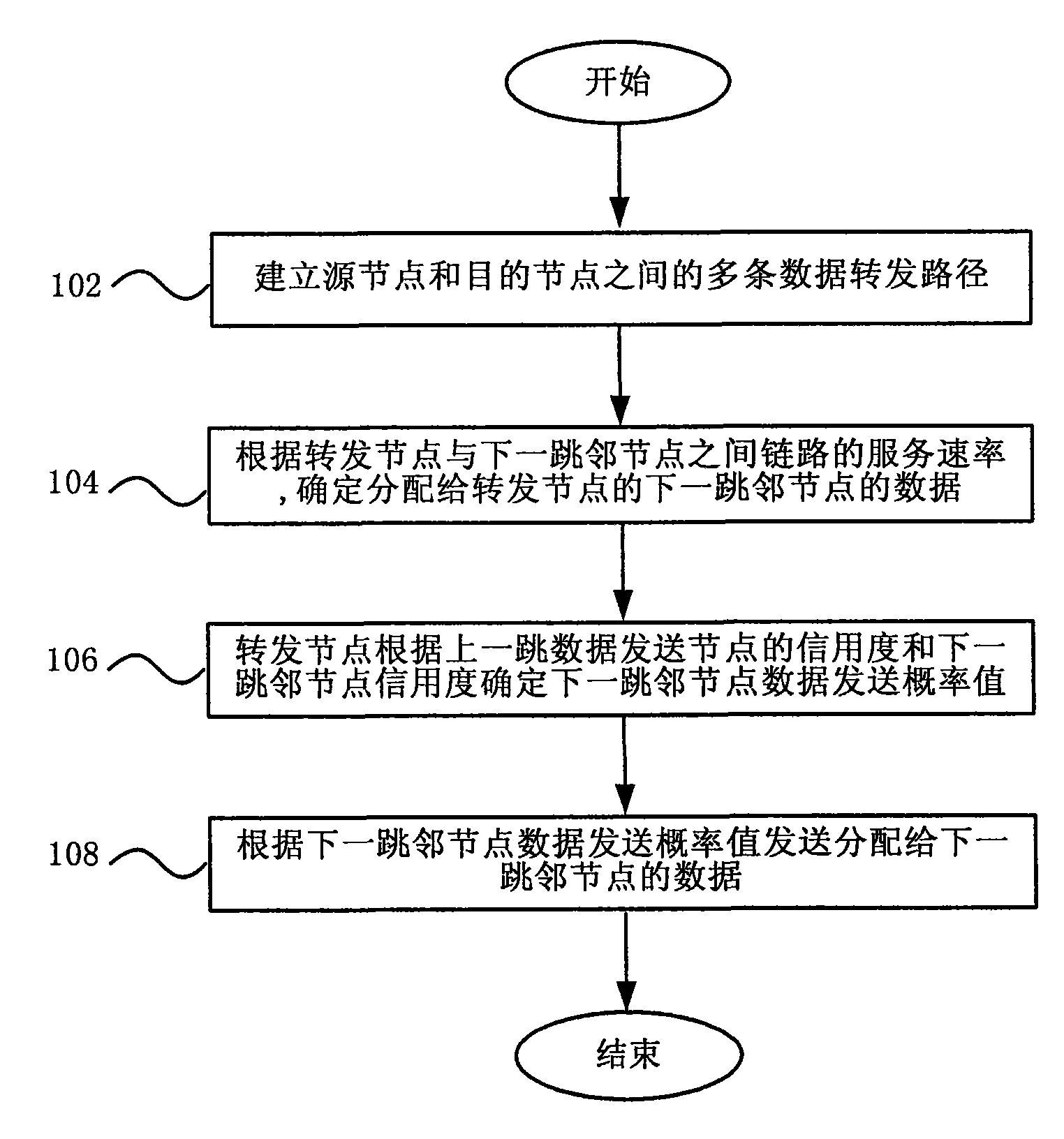

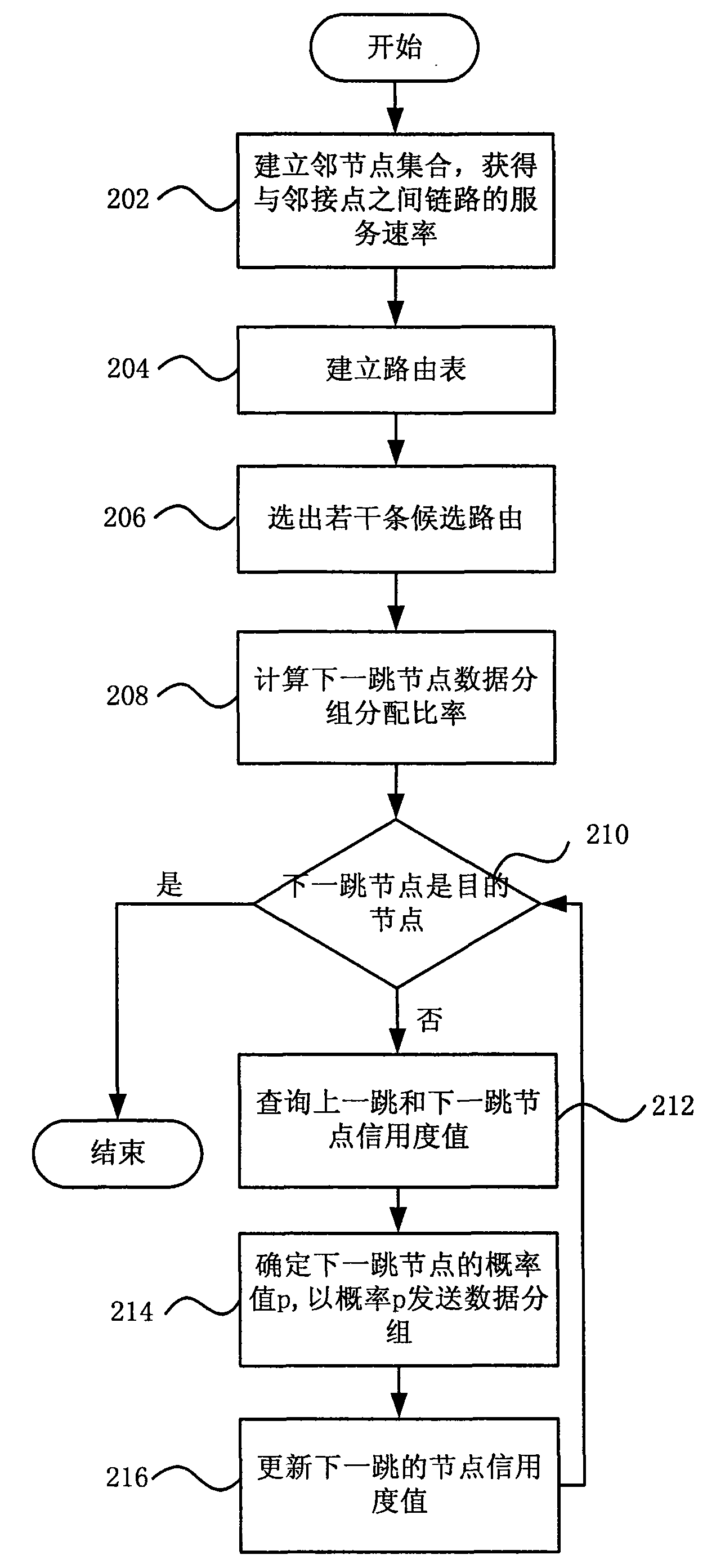

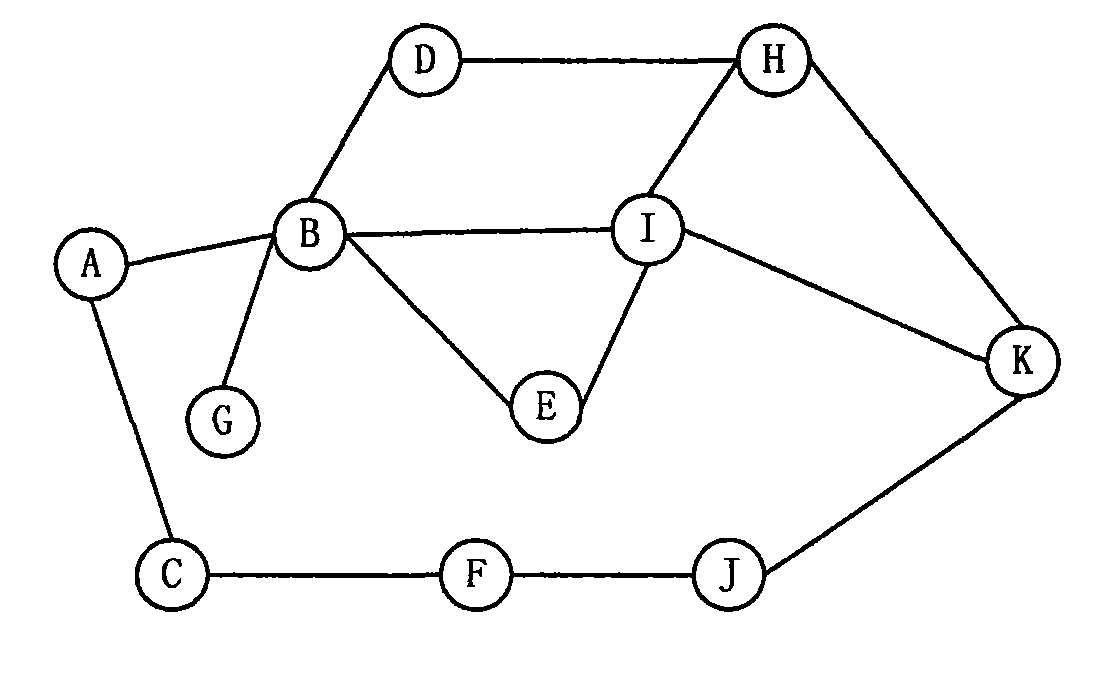

Distributed network routing method and routing device

InactiveCN101600227AImprove performanceLoad balancingNetwork traffic/resource managementData transmissionDistributed computing

The invention discloses a distributed network routing method and a routing device. The method comprises the following steps: at least two data switching routes between source nodes and target nodes are established; the switching nodes determine data allocated to the next hop of adjacent nodes according to service speed of utility functions and links of the next hop of adjacent nodes; the switching nodes, according to credit line of last hop of data, and the credit line of the next hop of adjacent nodes, determines data transmission probability value of the next hop of adjacent nodes; according to the probability value of the next hop of adjacent nodes, data allocated to the next hop of adjacent nodes is transmitted. The routing method and routing device of the invention take into consideration loading condition and service speed of nodes in the network, achieve the final balance of network internal loading by establishing a utility equation, can effectively reduce grouping time delay and improve network performance. In addition, to eliminate selfish behavior of nodes, the routing selection mechanism also combines the method of coordination and incentive to better improve the performance of the network.

Owner:BEIJING UNIV OF POSTS & TELECOMM

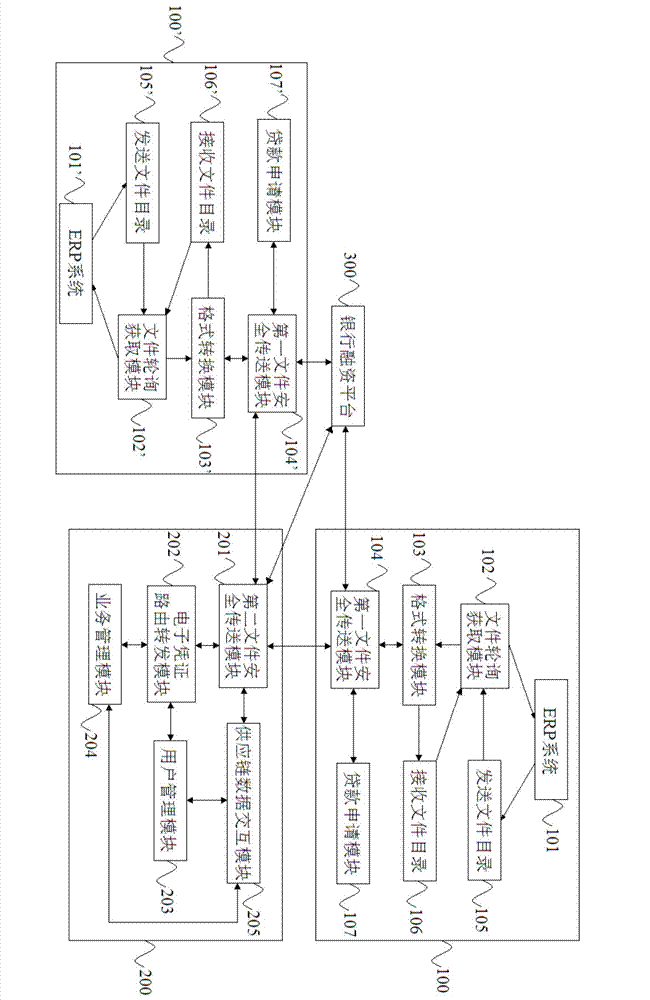

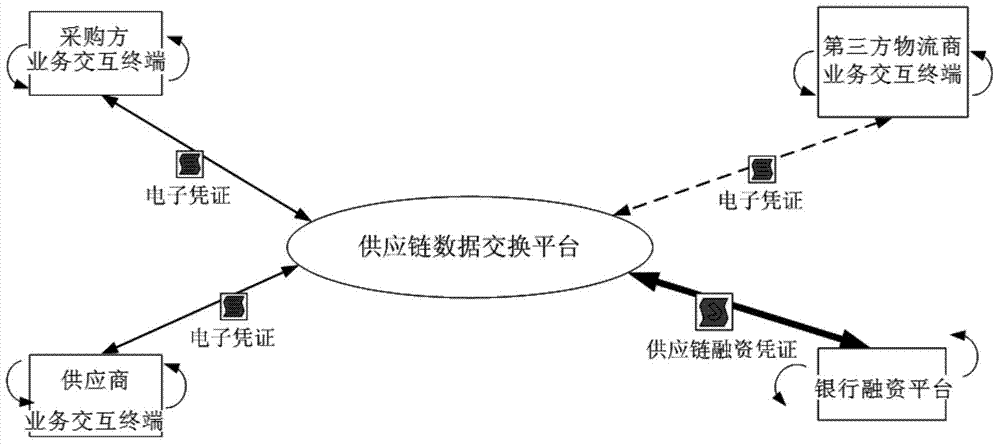

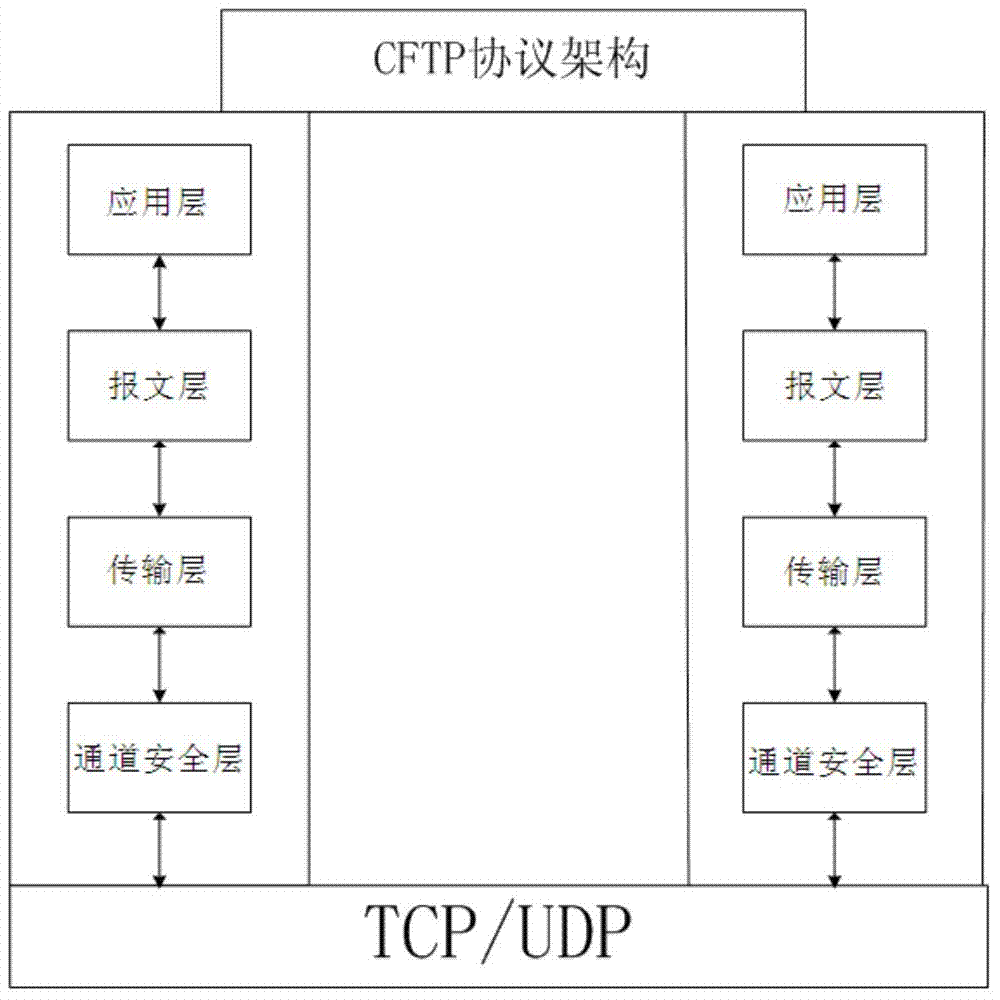

System and method for quantitative evaluation and online monitoring of Internet finance lending risk

The invention discloses a system for quantitative evaluation and online monitoring of Internet finance lending risk. The system comprises a supply chain data exchange platform, a bank financing platform and at least two business interactive terminals. The invention further discloses a method for quantitative evaluation and online monitoring of the Internet finance lending risk, wherein the method is adopted by the system for quantitative evaluation and online monitoring of the Internet finance lending risk. By the adoption of the system and method for quantitative evaluation and online monitoring of the Internet finance lending risk, supply chain messages in Internet finance can be integrated and are provided for a bank in a safety mode to be used as a network credit financing certificate so that the bank can obtain the lines of credit of users corresponding to the business interactive terminals according to a preset credit line mathematical calculation model, the lines of credit of the users are used for quantitative evaluation of the lending risk, the operation condition of each corresponding user is detected in real time after lending based on all the data, and then the purpose that the lending risk is monitored online in real time is achieved.

Owner:中企永联数据交换技术(北京)有限公司

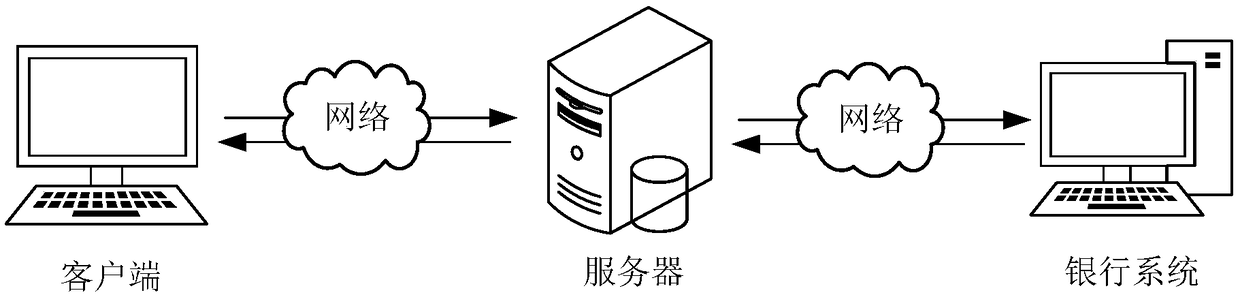

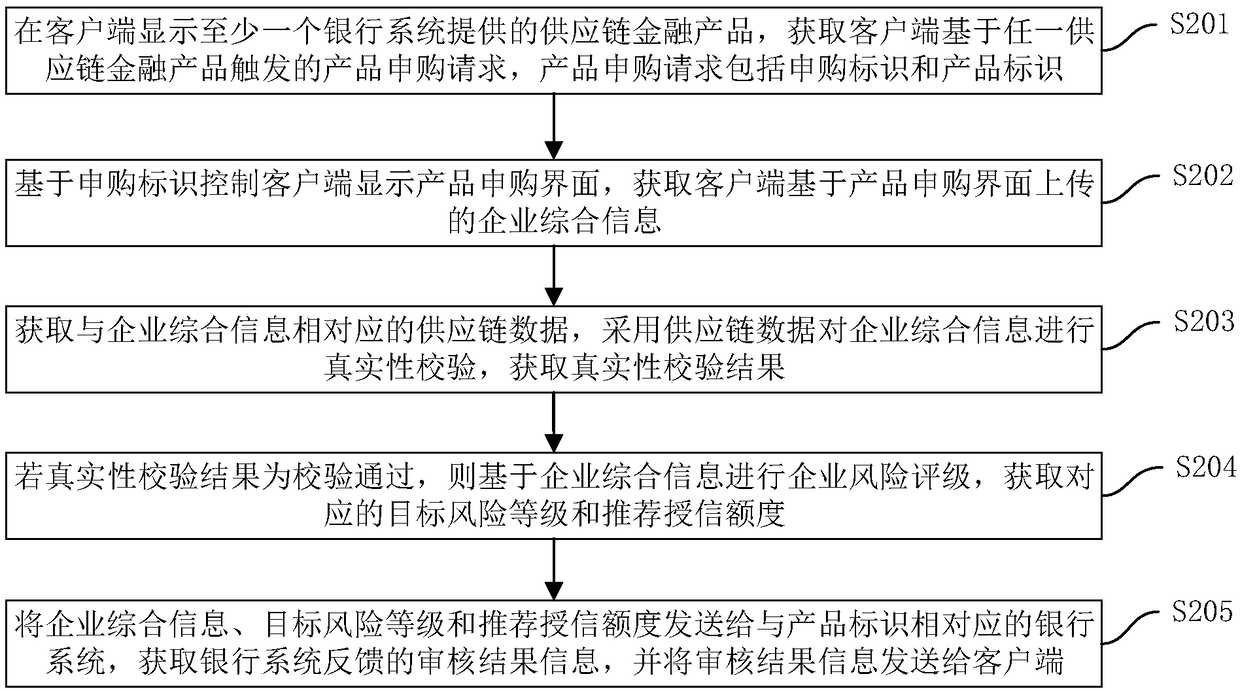

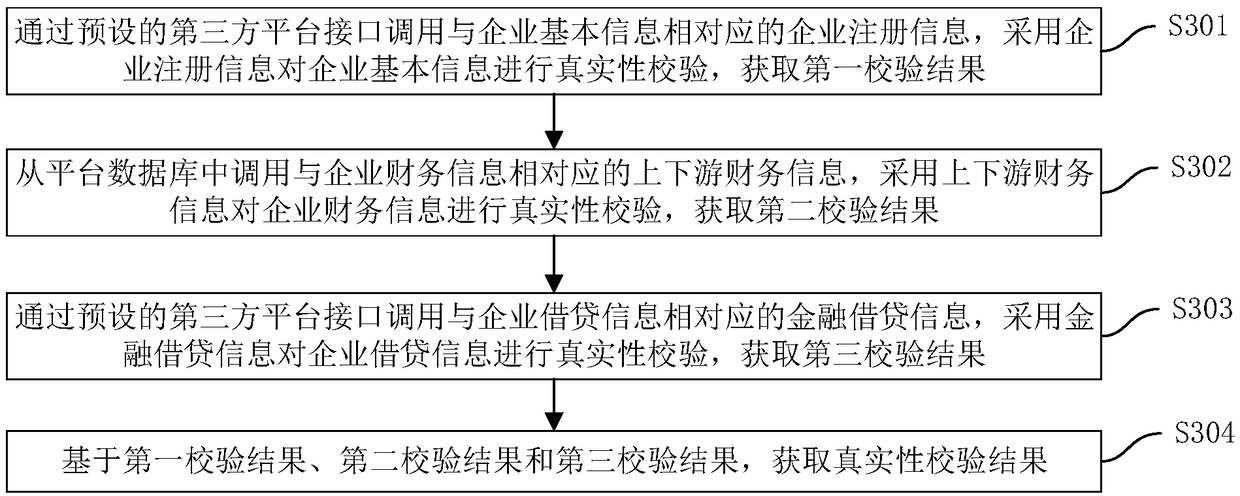

Supply chain financial service processing method, device, computer device and storage medium

The invention discloses a supply chain financial service processing method, a device, a computer device and a storage medium. The method comprises the following steps: displaying at least one supply chain financial product provided by a banking system on a client end, and obtaining a product purchase request triggered by the client end based on any supply chain financial product; Obtaining the comprehensive enterprise information uploaded by the client based on the product requisition interface; Acquiring the supply chain data corresponding to the comprehensive information of the enterprise, verifying the authenticity of the comprehensive information of the enterprise by using the supply chain data, and obtaining the authenticity verification results; If the authenticity verification result is passed, carrying out the enterprise risk rating based on the comprehensive information of the enterprise, and the target risk grade and the recommended credit line are obtained. The comprehensive information of the enterprise, the target risk grade and the recommended credit line are sent to the corresponding bank system of the product identification, and the review result information fed back by the bank system is sent to the client. This method can realize the information integration and enterprise qualification examination of supply chain financial products.

Owner:ONE CONNECT SMART TECH CO LTD SHENZHEN

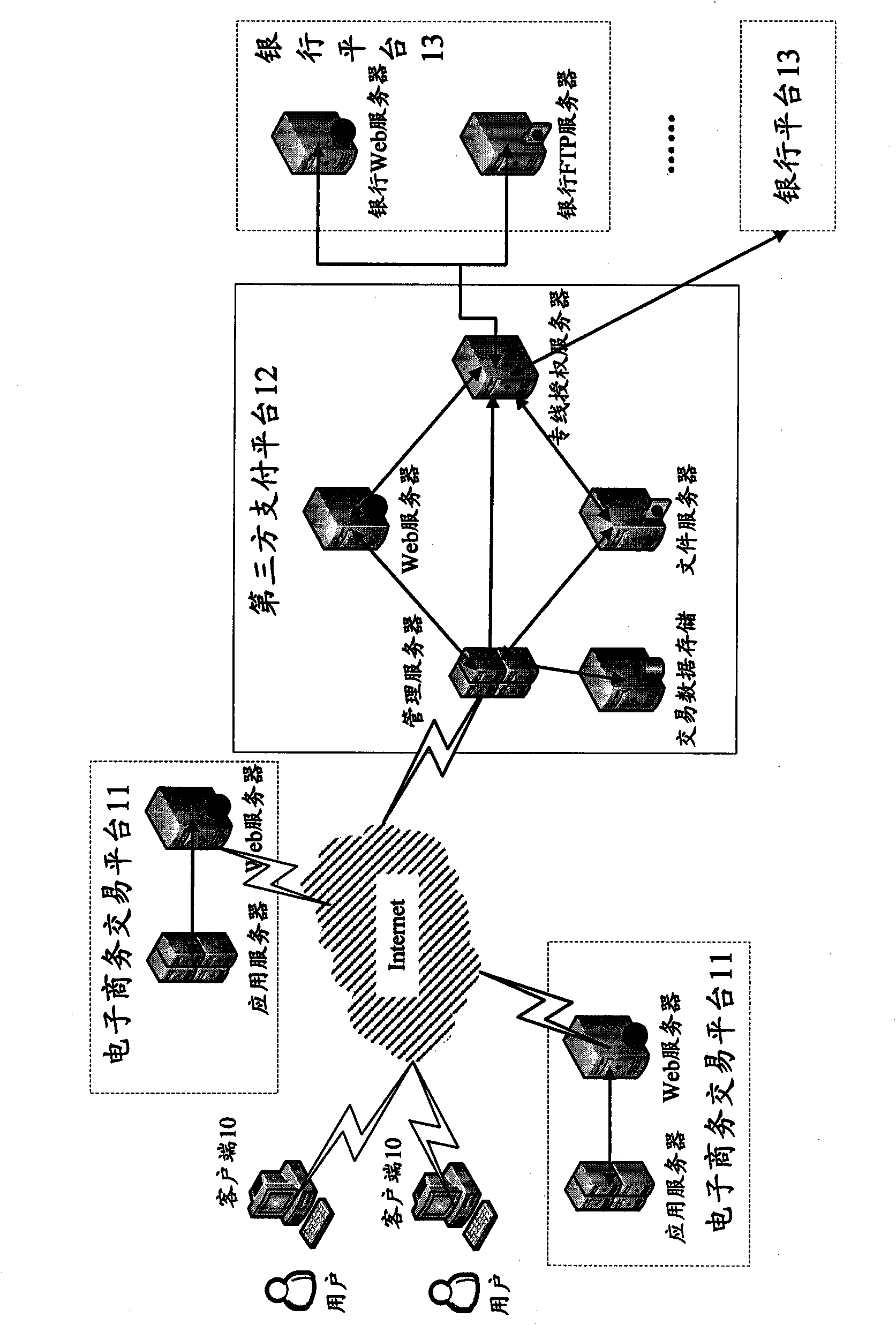

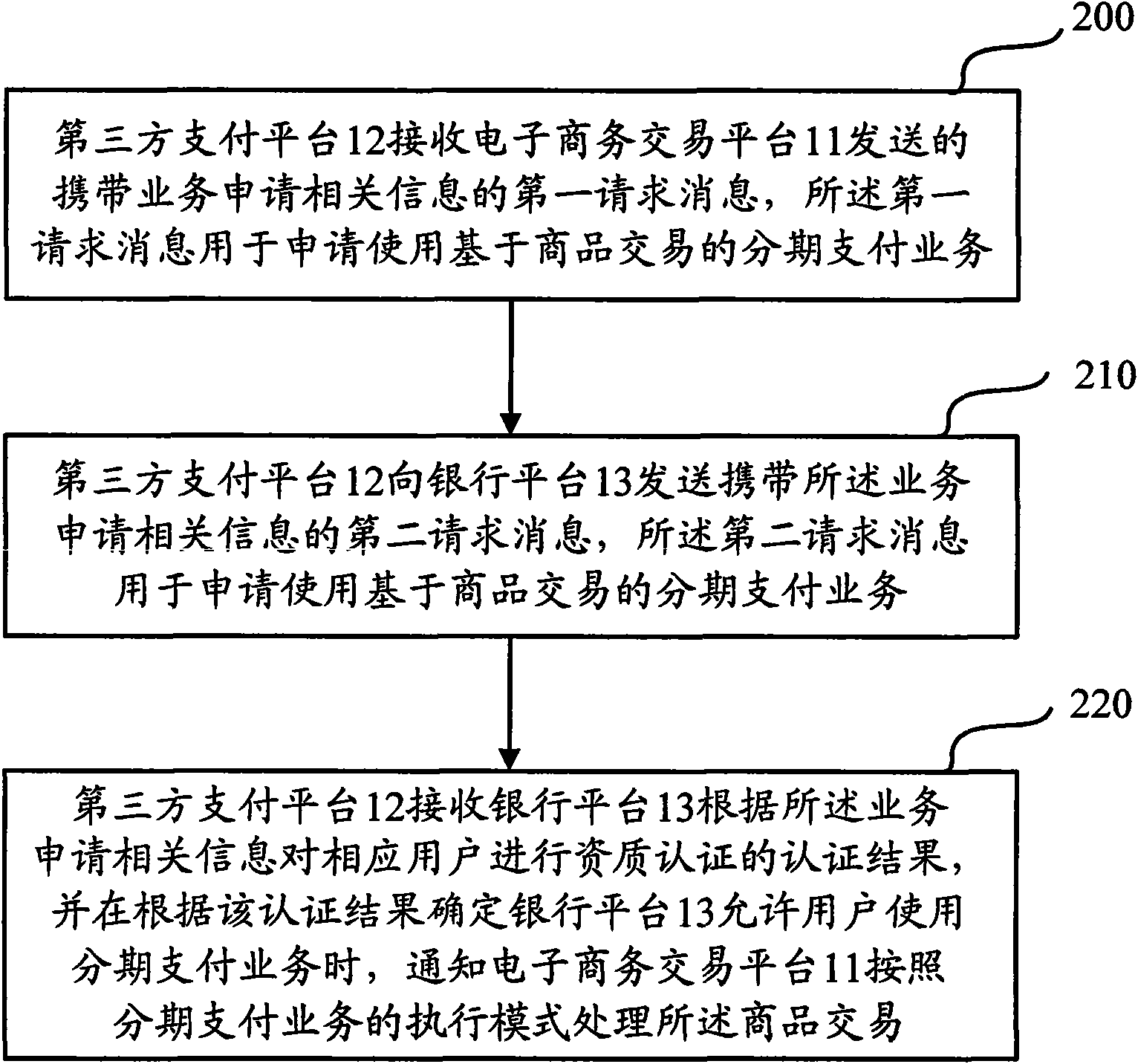

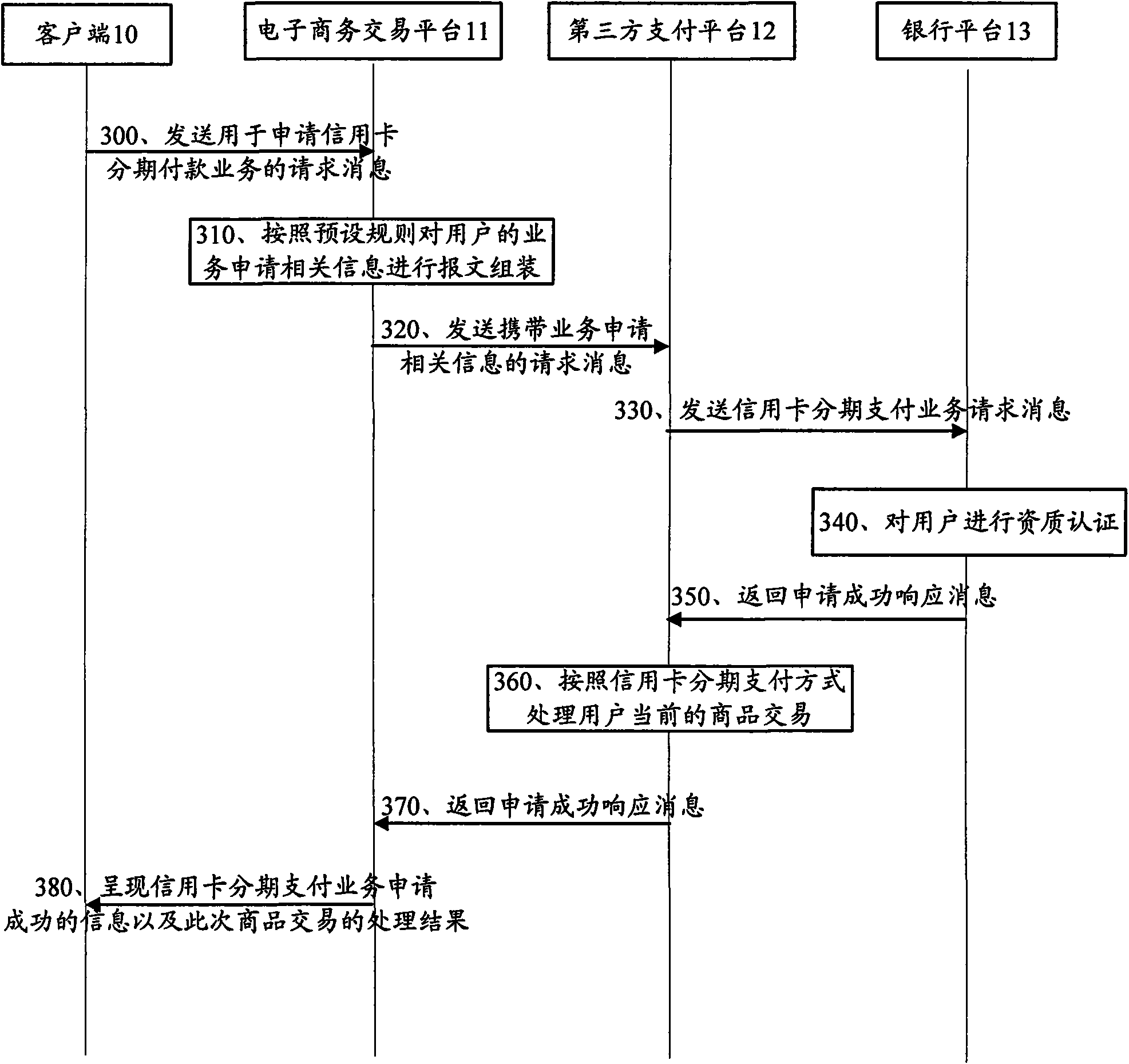

Method and system for achieving service of payment in installments

InactiveCN101599150AShorten the payment processImprove processing efficiencyCredit schemesCommerceThird partyRelevant information

The invention discloses a method for achieving a service of payment in installments, which comprises the following steps that: after receiving a first request message sent by an electronic commerce transaction platform and carrying service application related information, a third-party payment platform sends a second request message carrying the service application related information to a bank platform, wherein the first request message and the second request message are used for applying for the use of the service of payment in installments based on commodity transaction; and the third-party payment platform receives the certification results after the bank platform performs qualification and credit line certifications on a corresponding user according to the service application related information, processes the commodity transaction according to the service of payment in installments when the bank platform is confirmed to allow the user to use the service of payment in installments according to the certification results, and informs the electronic commerce transaction platform of the processing result. Thus, the method effectively prevents user data from being disclosed, improves the security of the commodity transaction, and simultaneously, greatly shortens the payment process of the commodity transaction and saves the payment time. The invention discloses a system for achieving the service of payment in installments at the same time.

Owner:ALIBABA GRP HLDG LTD

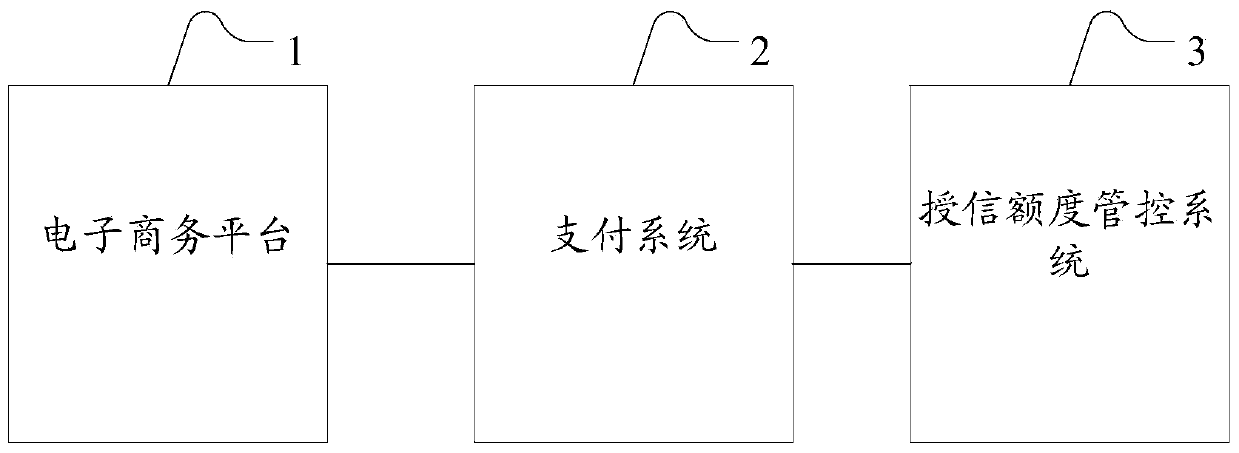

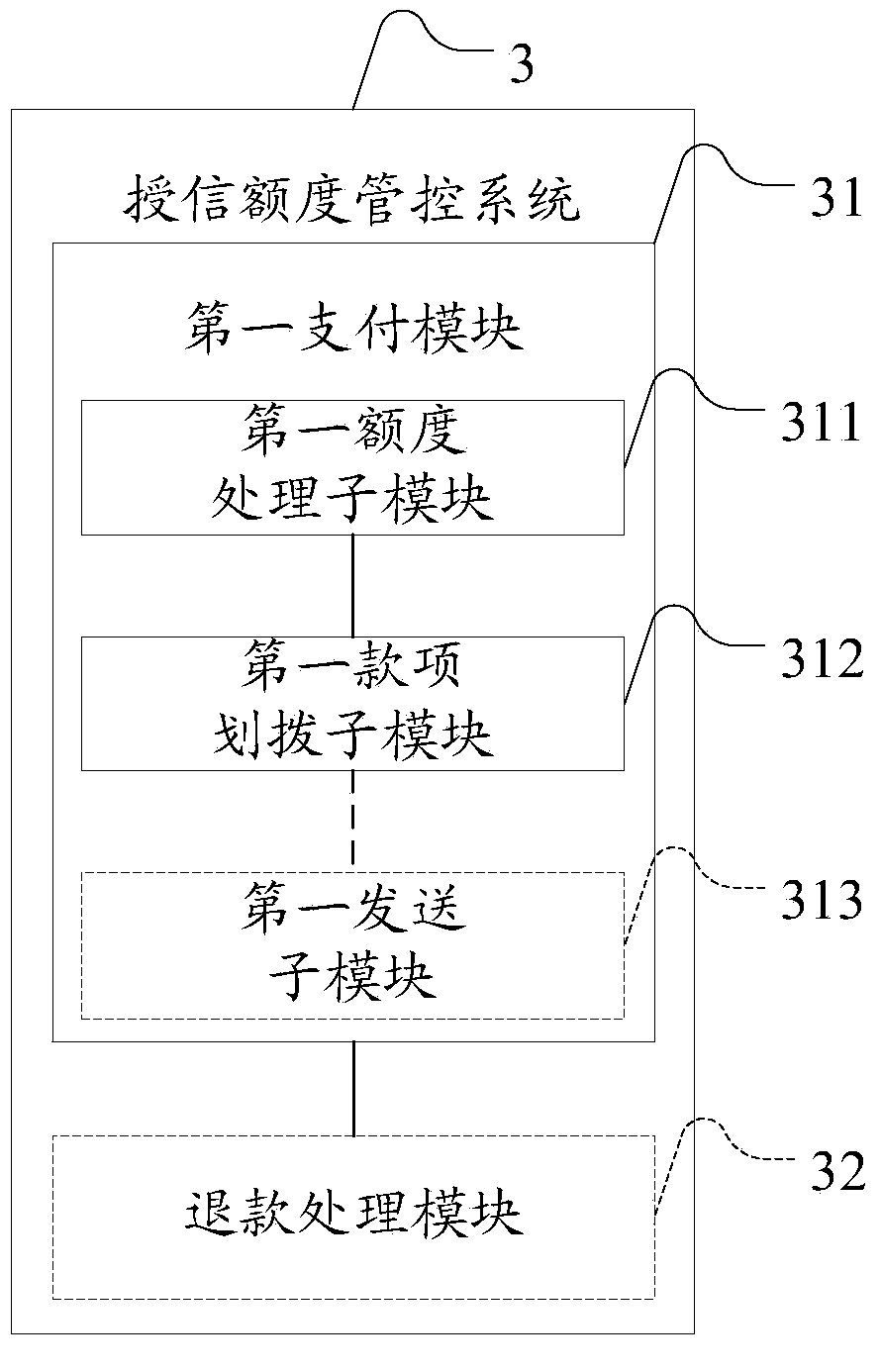

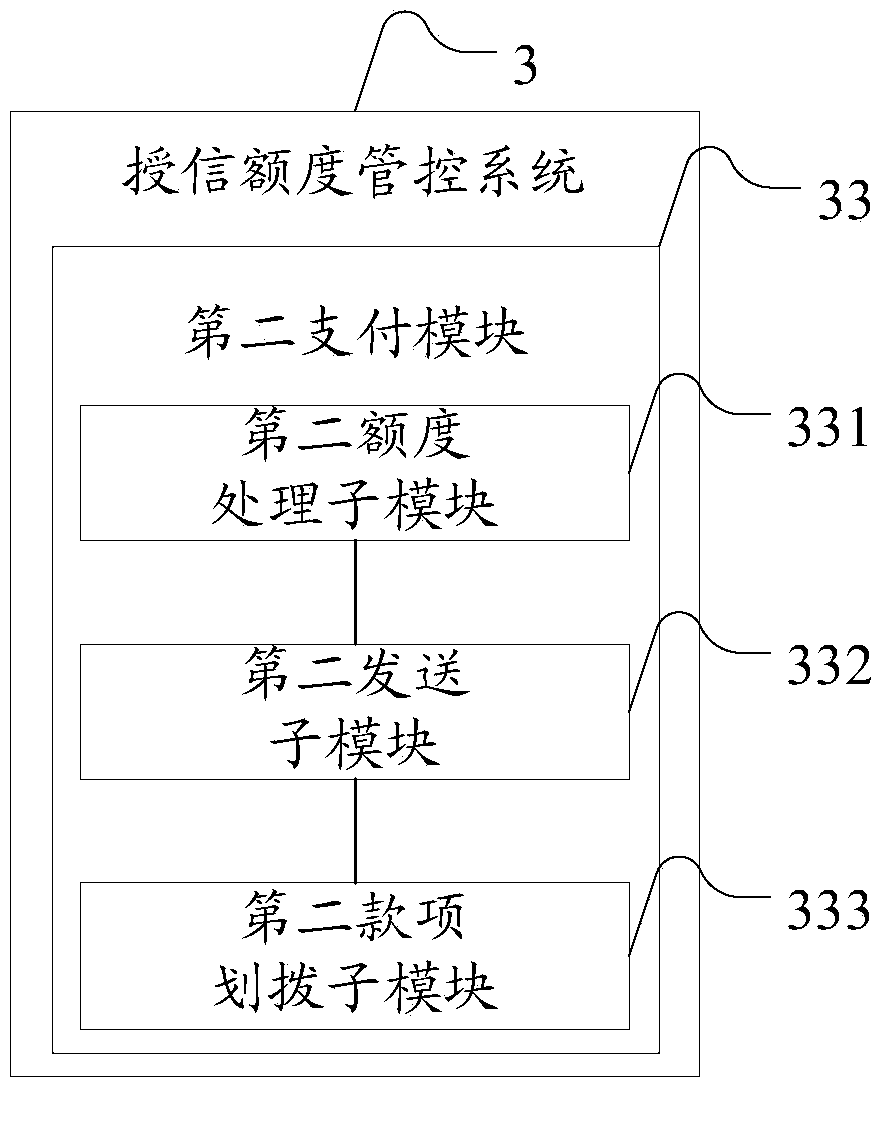

Data processing system and method suitable for financing payment

InactiveCN104200356AImprove experienceEasy to useFinanceCredit schemesData processing systemControl system

The invention provides a data processing system and method suitable for financing payment. The data processing system comprises an e-commerce platform, a payment system and a credit line management and control system, wherein the e-commerce platform is used for generating a financing transaction order according to commodities selected by a user at a store of a merchant, and the financing transaction order and a financing credit expended mode selected by the user are sent to the payment system; the payment system is used for performing identity authentication on the user, and after the identity authentication passes, amount of money of the financing transaction order and the financing credit expended mode are sent to the credit line management and control system; the credit line management and control system is used for storing credit line of the user, and credit line processing and fund appropriating processing are performed according to the amount of money and the financing credit expended mode. By means of the data processing system and method suitable for financing payment, individual credit line and currently popular e-commerce can be combined, on-line payment can be achieved by means of individual credit line, the credit line of the user can be fully utilized, the usage of funds in individual credit line is quite convenient and rapid, and user experience is improved.

Owner:CHINA CONSTRUCTION BANK

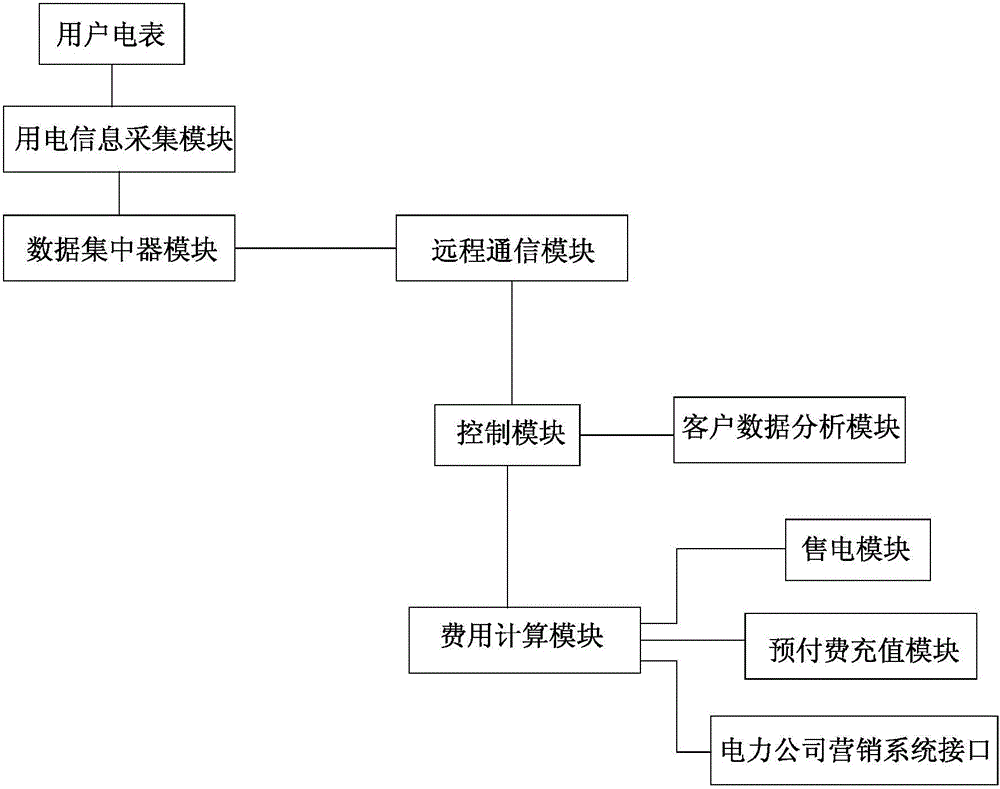

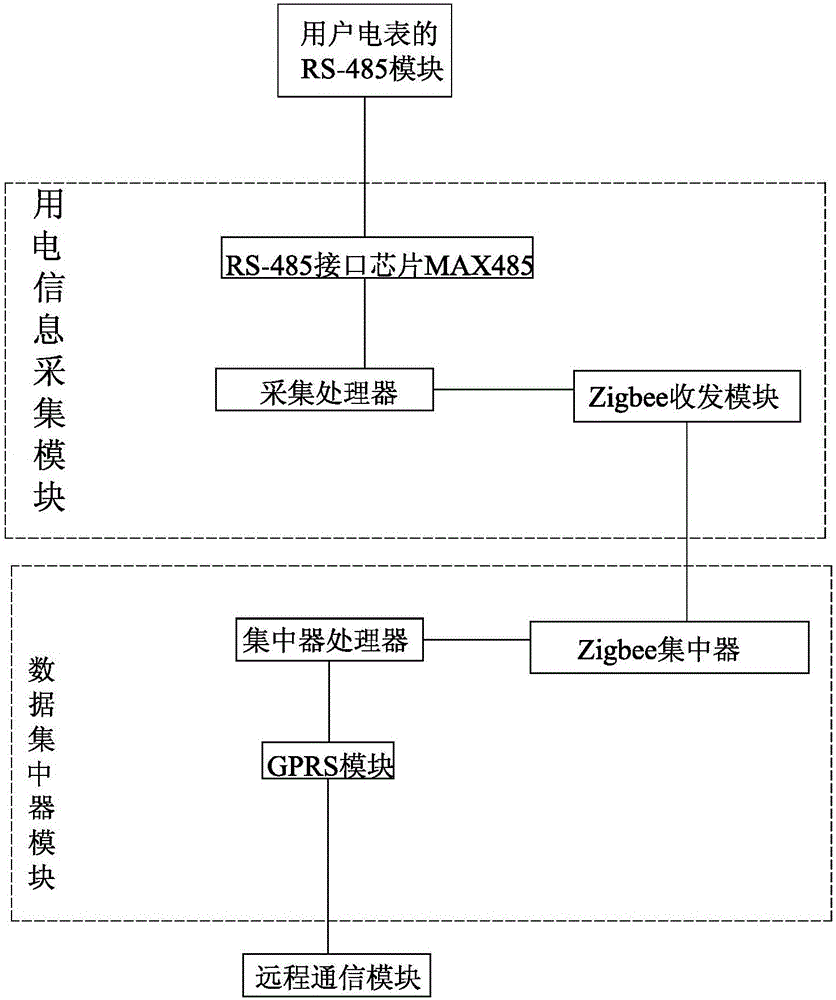

Remote and real-time charge control management system and method

InactiveCN106204931AAccurate creditGood electricity experienceData processing applicationsApparatus for hiring articlesReal-time chargingTime limit

The invention discloses a remote and real-time charge control management system and method. An electricity utilization information acquisition module acquires electricity utilization information of a user electricity meter in real time, and a data concentrator module stores at least 31 daily zero-frozen electric energy data and 12 month-end-frozen electric energy data of each customer electric energy meter; a charge calculation module stores payment history data of user accounts, a customer information grouping and modeling unit deep mines electricity utilization characteristics of the users, divides the users into different customer groups by combining data mining and gives different payment time limiting days and overdraft electric charge limit values which correspond to the characteristics according to the characteristics of the customer groups. According to the remote and real-time charge control management system and method, real-time and precise charge analysis is provided for the users, an electricity marketing department can conveniently extract and integrate the user information, grade the users and conduct fine management on the users by combining the credit line, and user experience is promoted.

Owner:JINAN LICHENG POWER SUPPLY CO OF STATE GRID SHANDONG ELECTRIC POWER CO +1

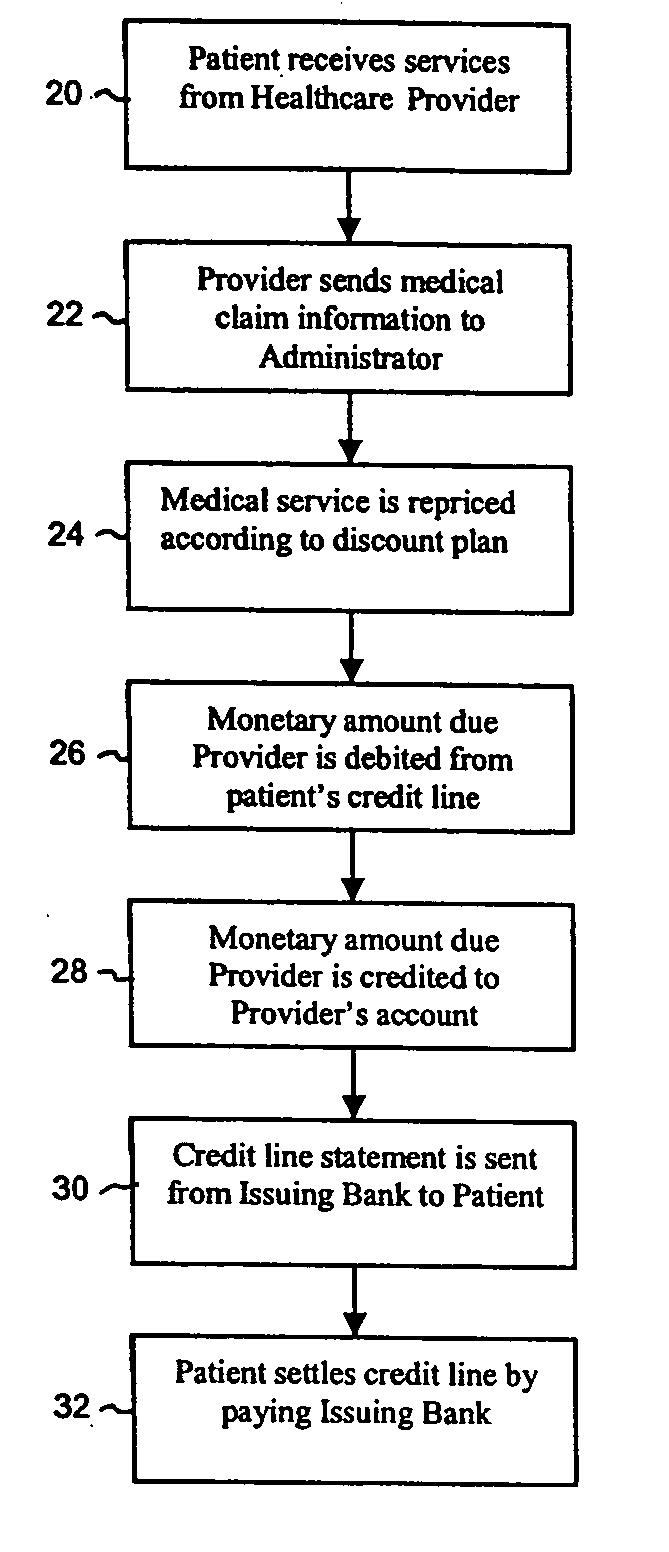

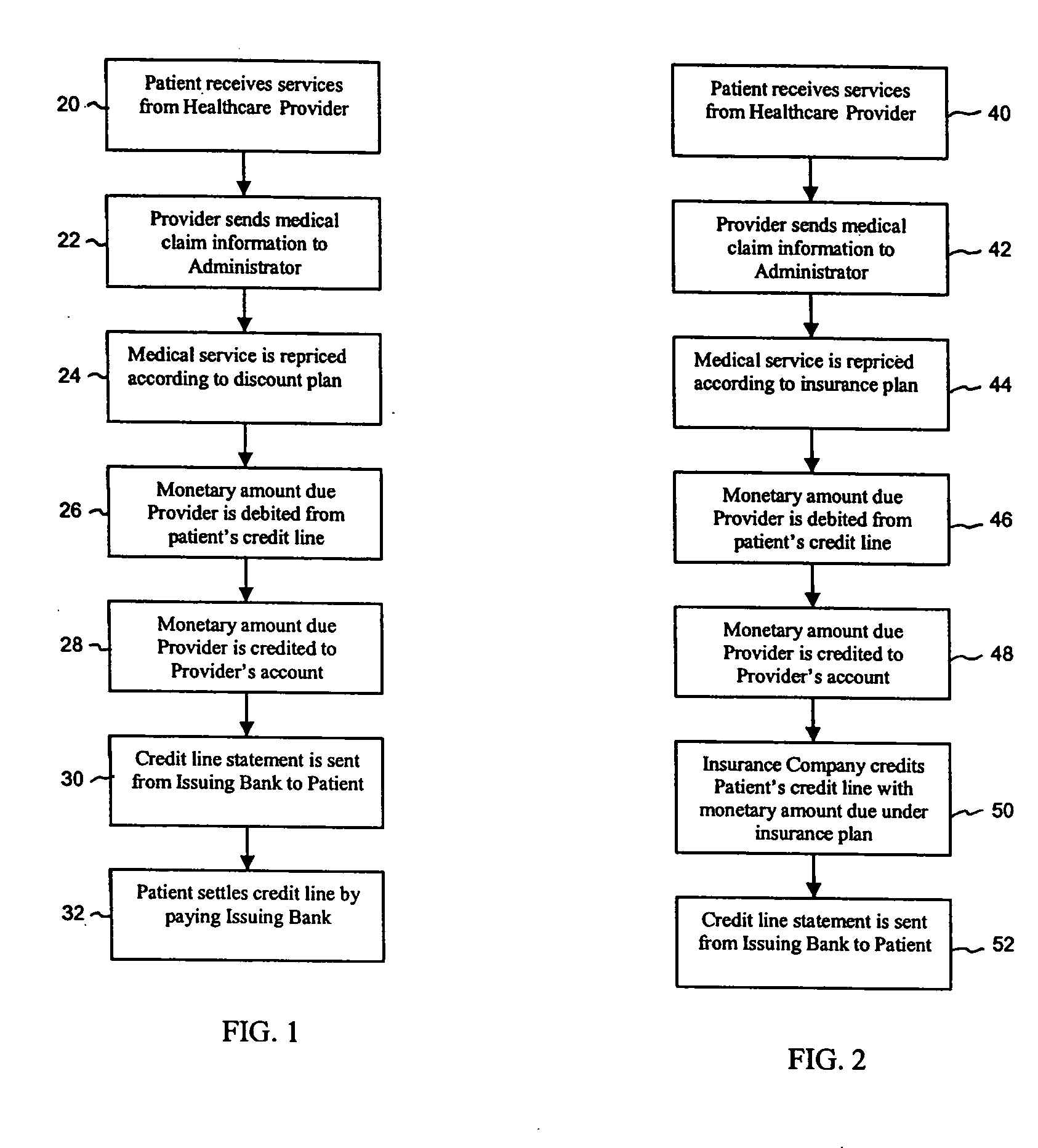

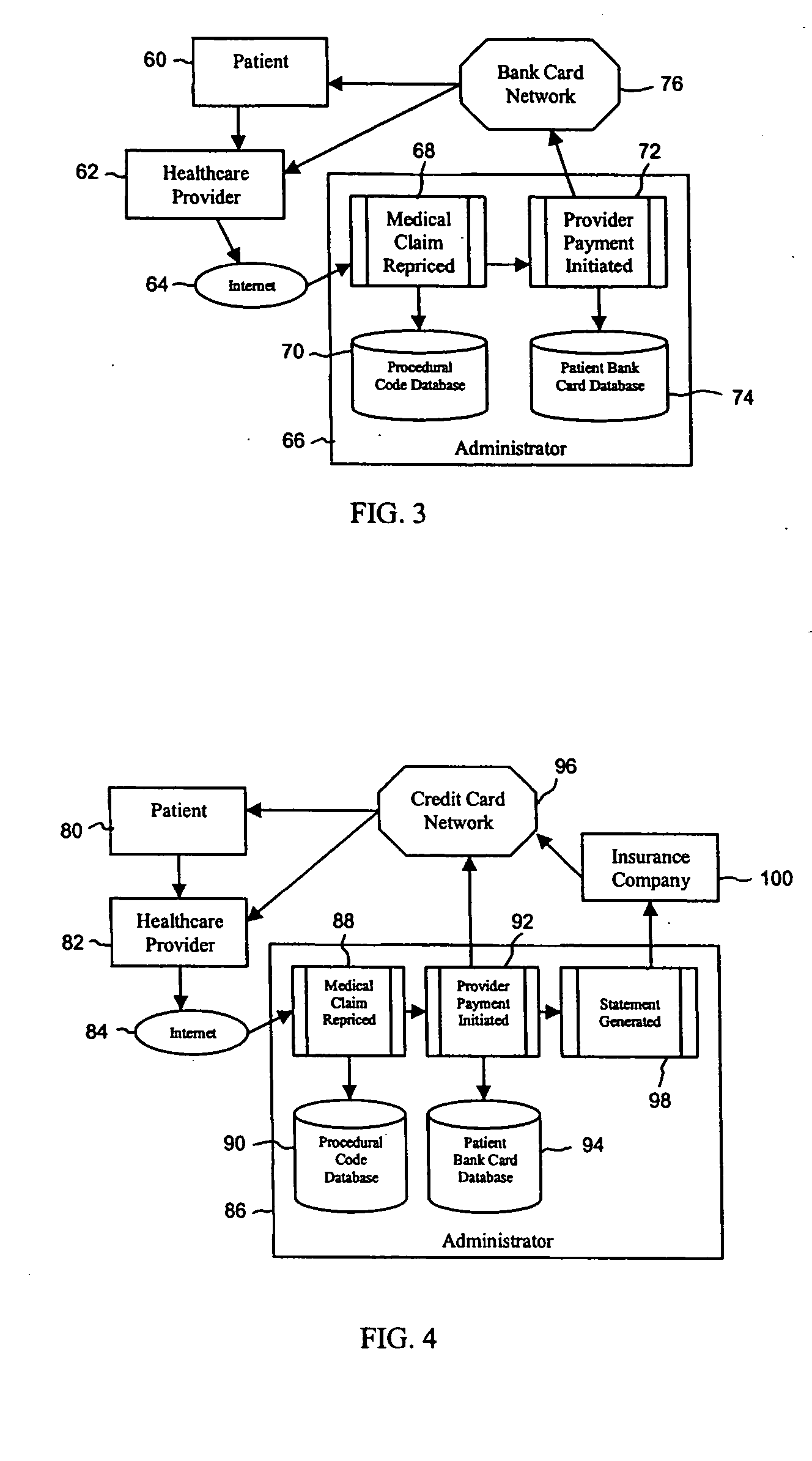

Method and system for settling a patient's medical claim

InactiveUS20050228700A1Quickly and efficiently settleQuick and efficient paymentFinanceOffice automationMedical treatmentNursing

A method and system for settling a patient medical claim from a healthcare provider. Medical claim information is received from the healthcare provider by an administrator on behalf of the patient's insurance company. A first monetary amount owed to the healthcare provider and a second monetary amount owed to the patient from the insurance company are determined. Using conventional bank card transaction settlement systems, the first monetary amount owed to the healthcare provider is debited from a credit line of the patient and deposited in a financial account of the healthcare provider to settle the patient medical claim. The second monetary amount is credited to the credit line of the patient by the insurance company.

Owner:BARCOMB CRAIG

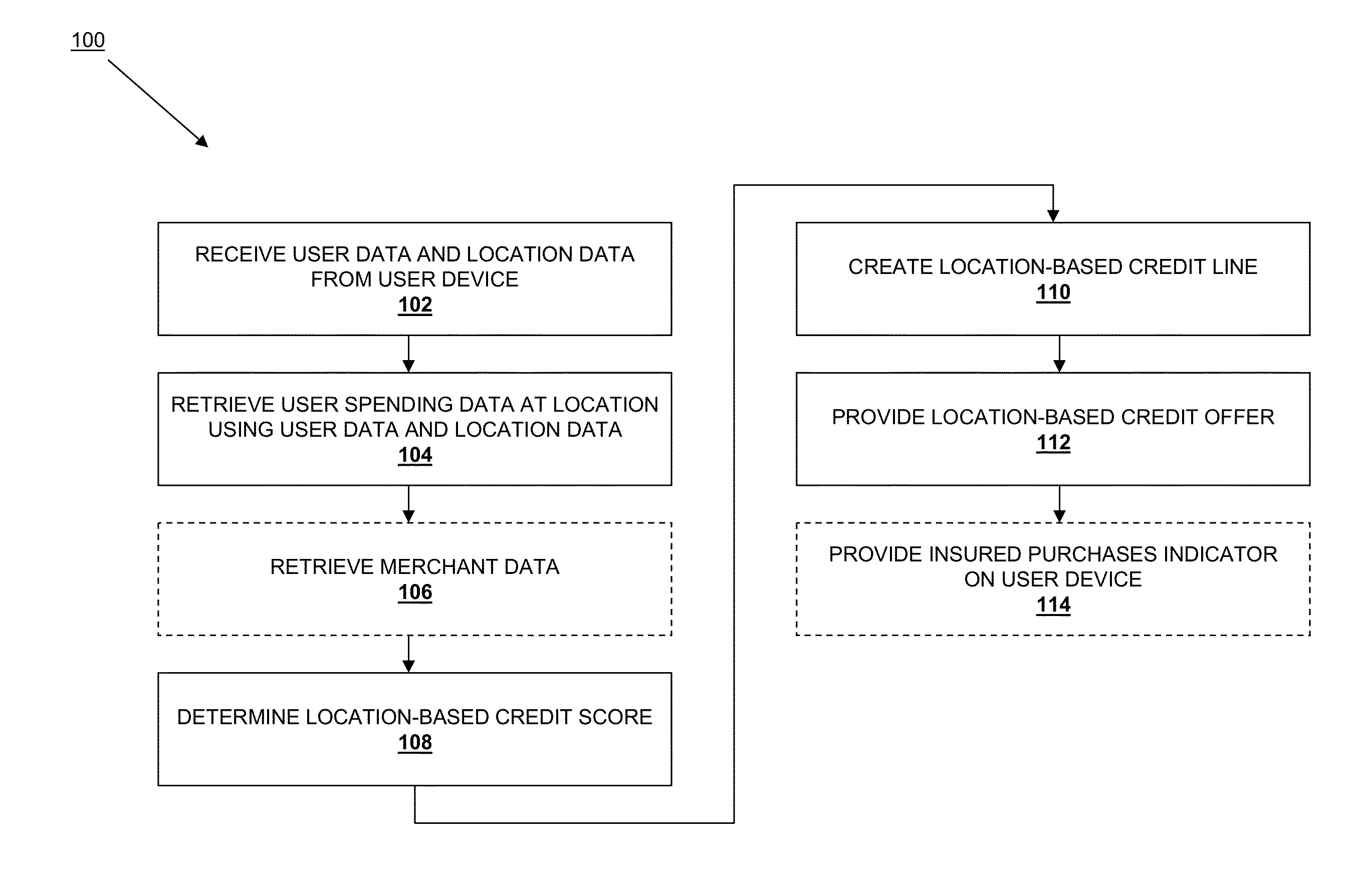

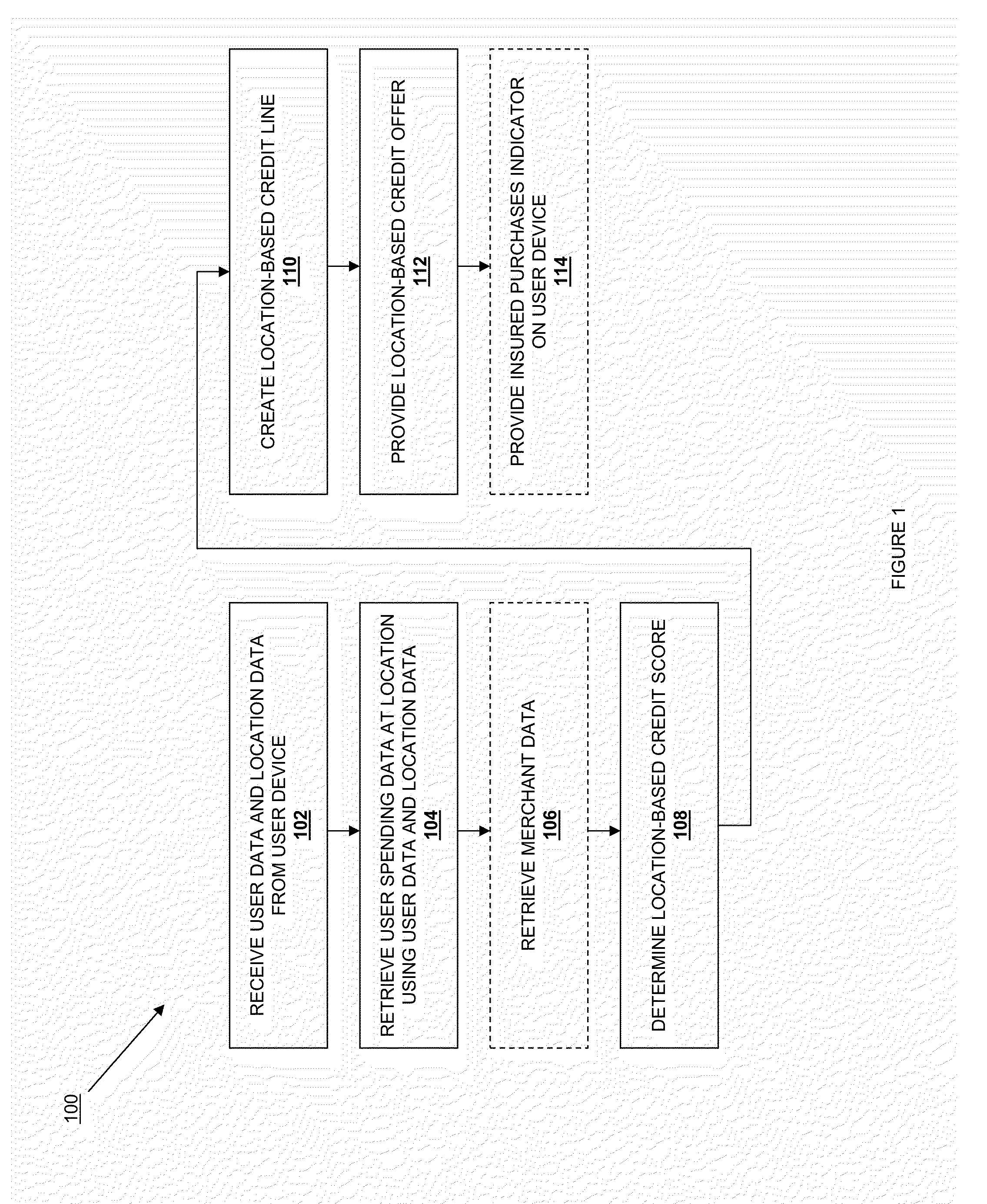

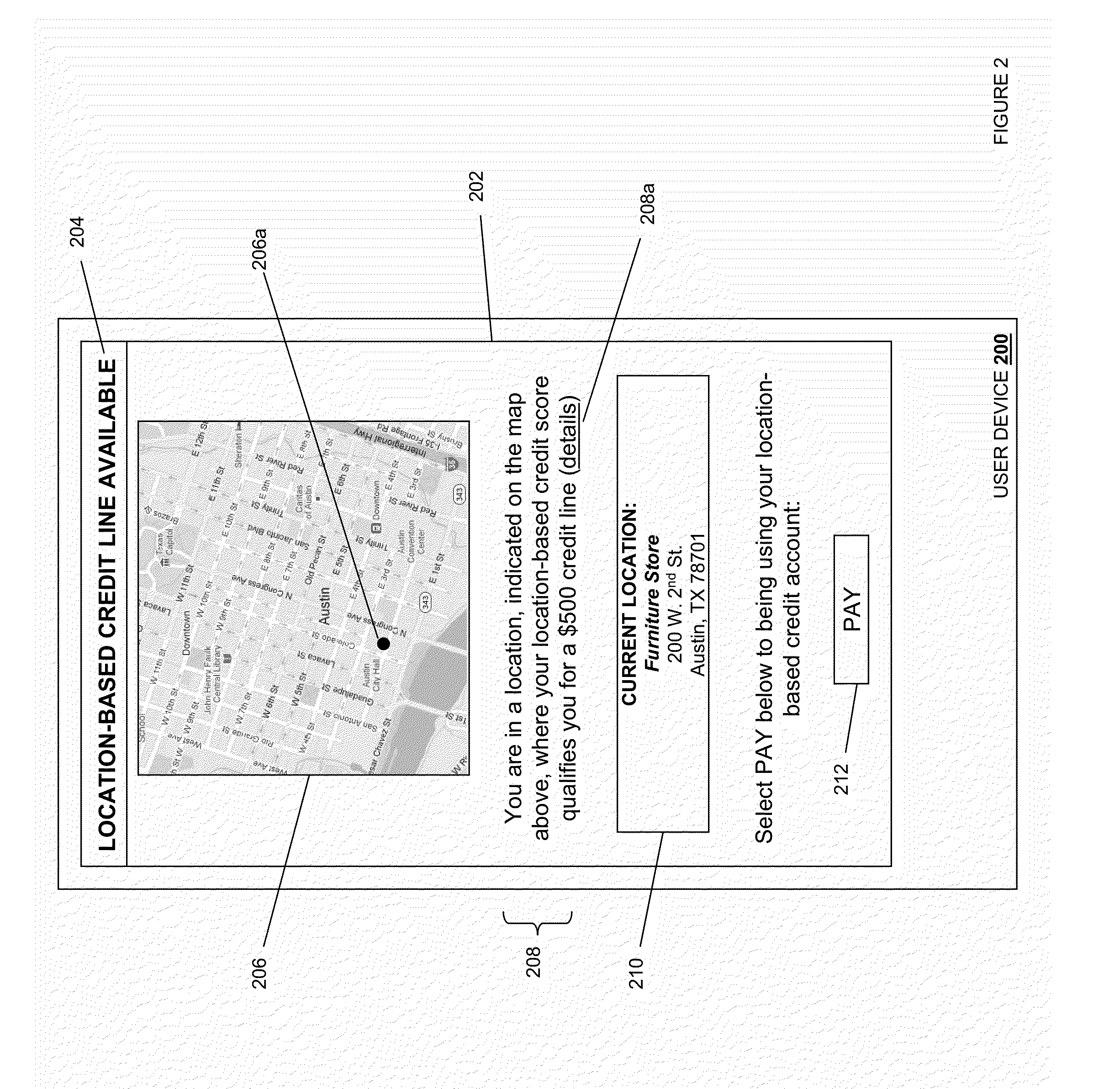

Location-based credit provision system

A method for providing credit to a user includes receiving user data associated with the user and location data associated with a location from a user device of the user over a network. User spending data for the user at the location is then retrieved from a database using the user data and the location data, and the user spending data is used to determine a location-based credit score for the user at the location. In some embodiments, merchant data for the location may also be retrieved to determine whether the location is a trusted merchant location and / or to help determine the location-based credit score. A location-based credit line for the user at the location is created in a database, and a location-based credit offer is sent to the user device over the network that includes an indication of the location-based credit line for the user at the location.

Owner:PAYPAL INC

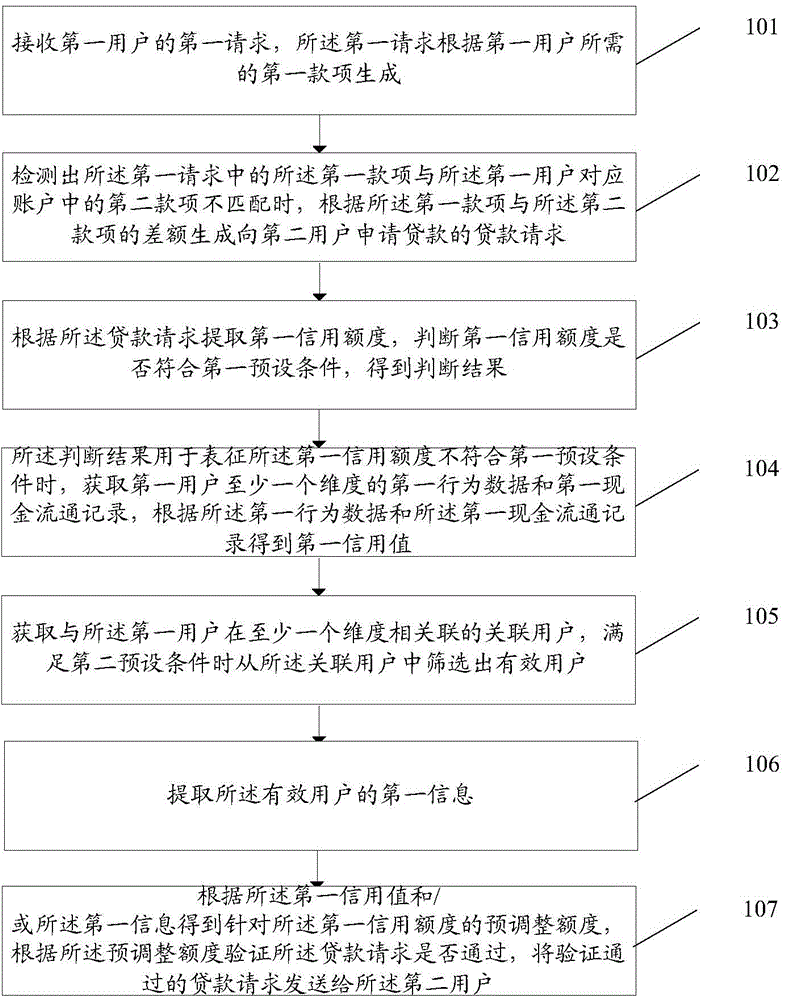

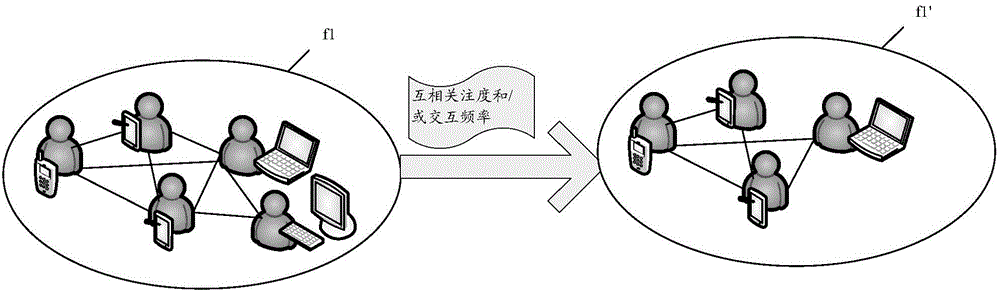

Data processing method and payment platform

The invention discloses a data processing method and a payment platform. The method is applied to the payment platform. The method comprises the steps of receiving a first request of a first user, wherein the first request is generated according to the first payment as the first user requirement; if that the first payment in the first request is unmatched with the second payment in the corresponding account of the first user is detected, generating a loan request of applying to the second user for loan according to the balance between the first payment and the second payment; extracting the first credit line according to the loan request; determining whether the first credit lint meets the first preset condition to obtain a determining result; extracting the first information of the validated user; obtaining the pre-adjusting limit of the first credit line according to the first credit value and / or the first information; verifying whether the loan request is passed according to the pre-adjusting limit; sending the verified load request to the second user.

Owner:TENCENT TECH (SHENZHEN) CO LTD

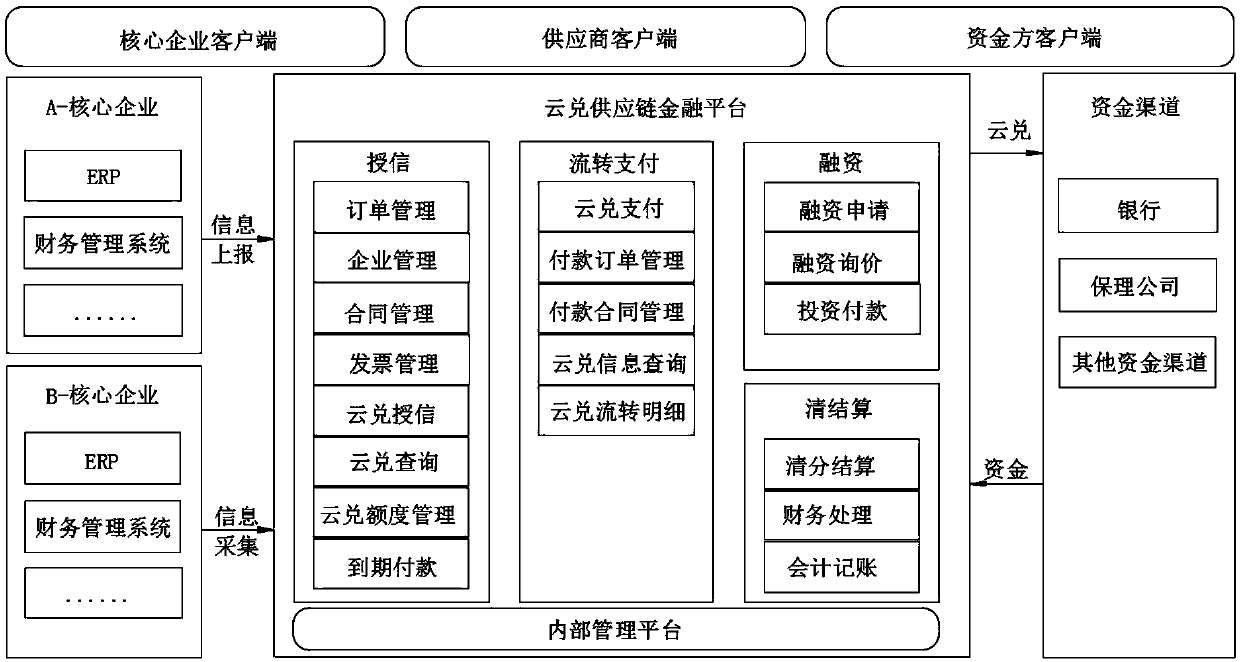

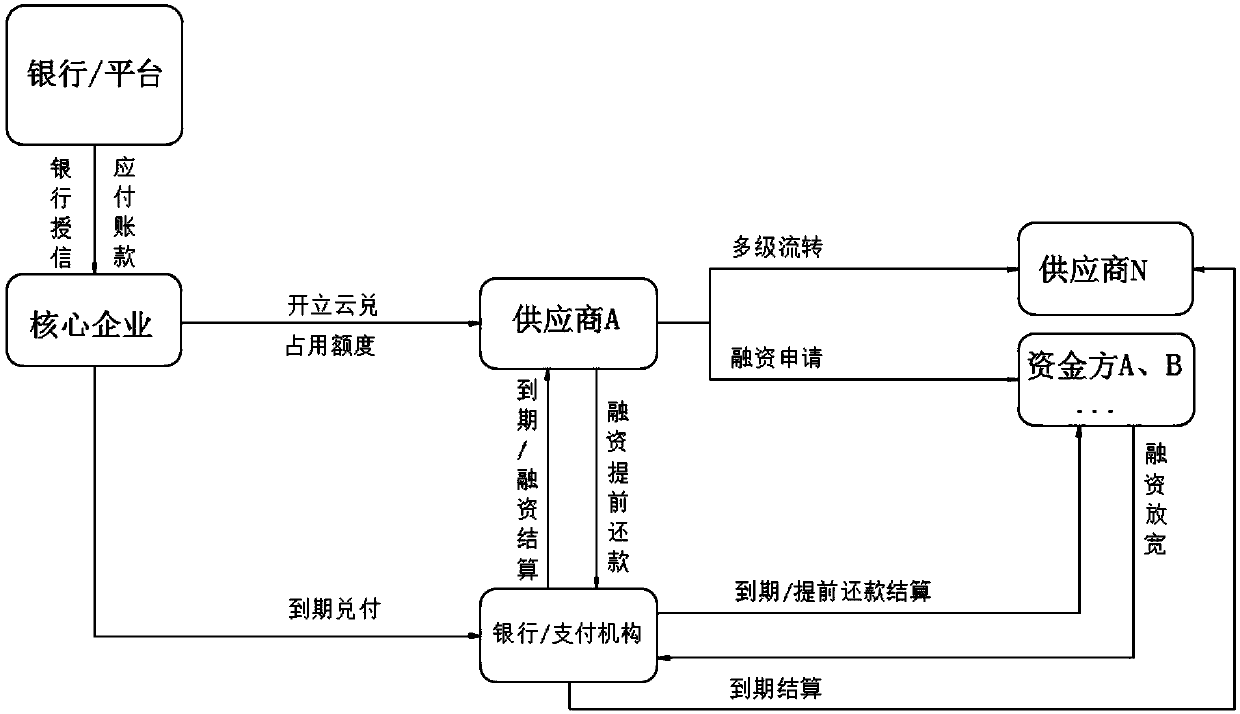

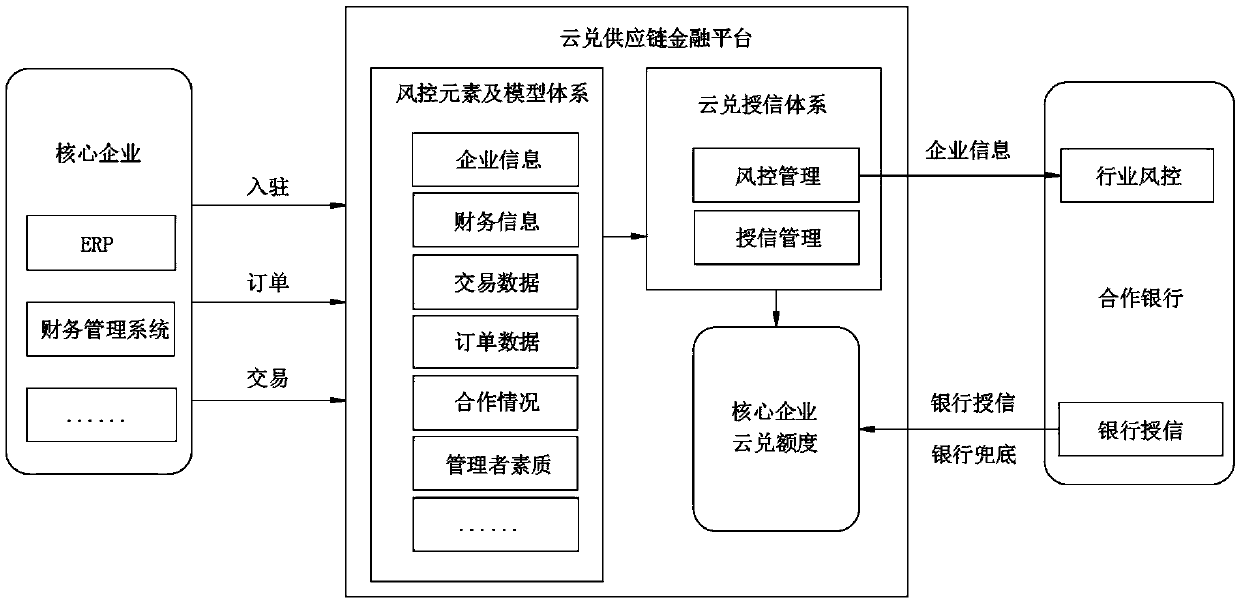

A supply chain financial software system and method

The invention discloses a supply chain financial software system and method, including a core enterprise client, a supplier client, a fund party client and an internal management platform,, the core enterprise client reports information to a background database of the internal management platform to obtain a cloud exchange credit line, the core enterprise sends the cloud exchange information in the credit line to the supplier client, and the supplier client sends the cloud exchange information to other enterprises for payment of goods. The invention discloses a supply chain financial softwaresystem and method. Firstly, separation of commodity exchange and currency exchange is realized; the requirements of a payment enterprise on operation funds are reduced; secondly, credit transfer of core enterprises is achieved, bank guarantee is achieved, the bad account risk of the seller is effectively reduced, online transfer and timely transfer of credit and related service information can beachieved, market demand information and financing party operation information can be accurately fed back, the financing risk is reduced, and a better use prospect is brought.

Owner:北京锐融天下科技股份有限公司

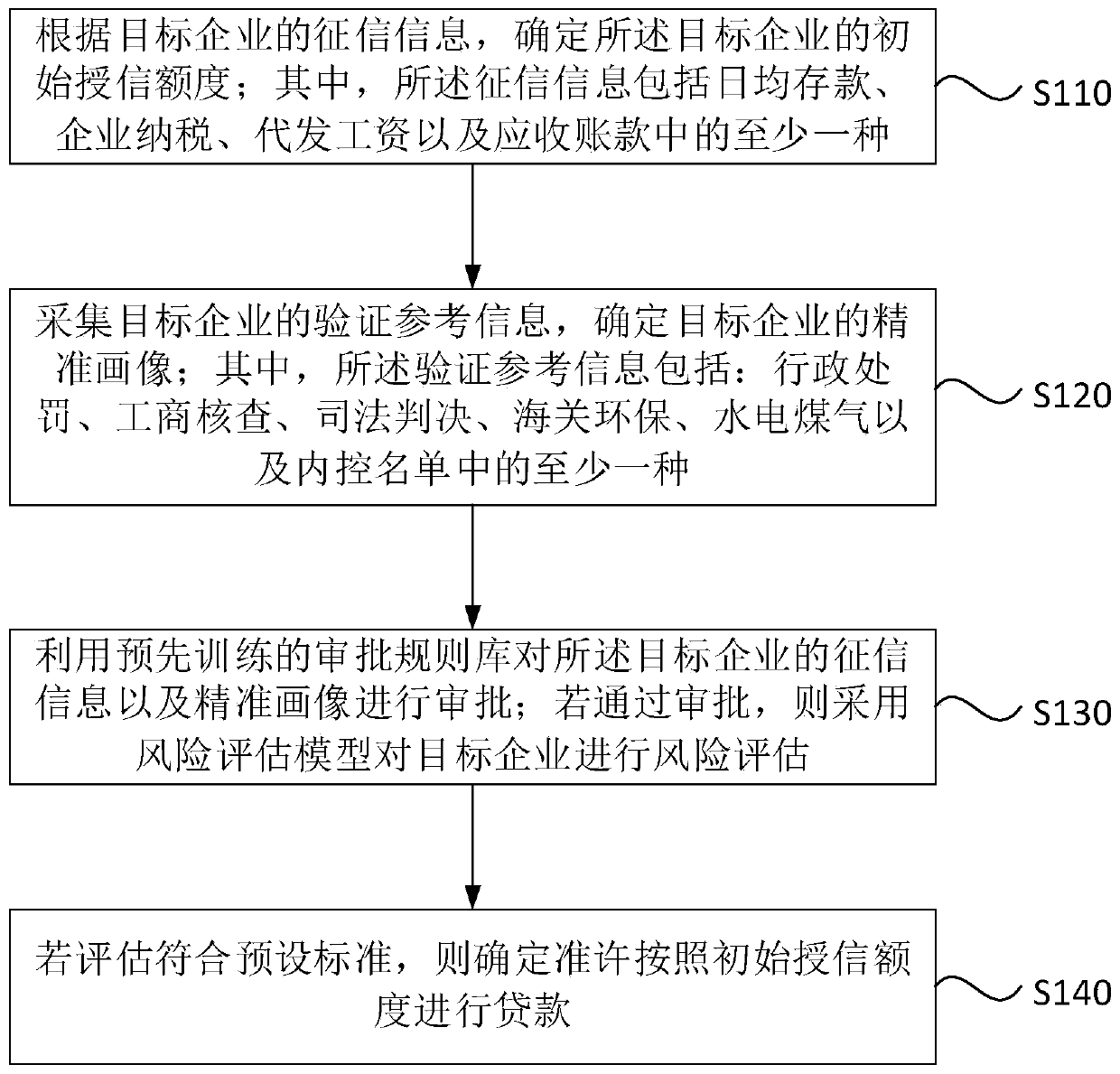

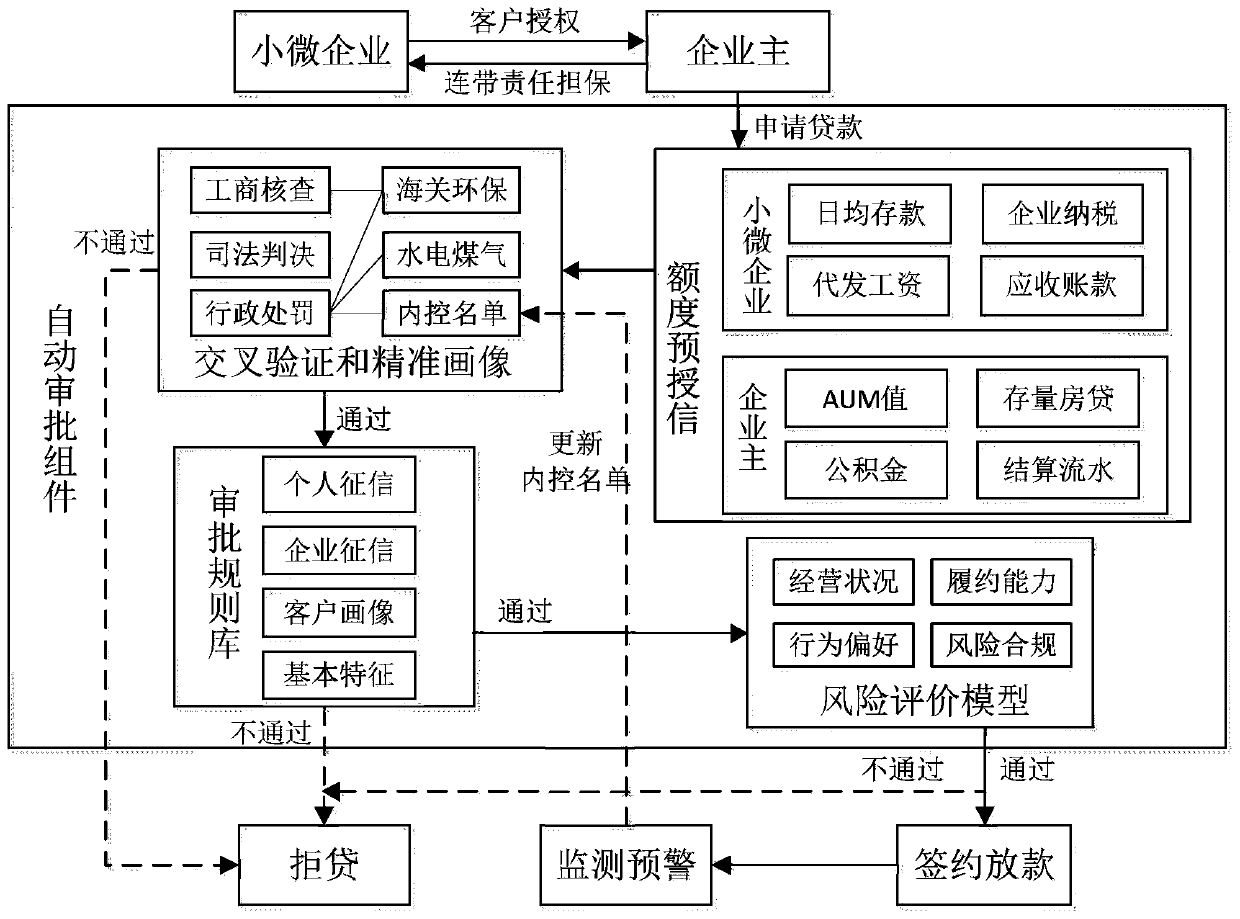

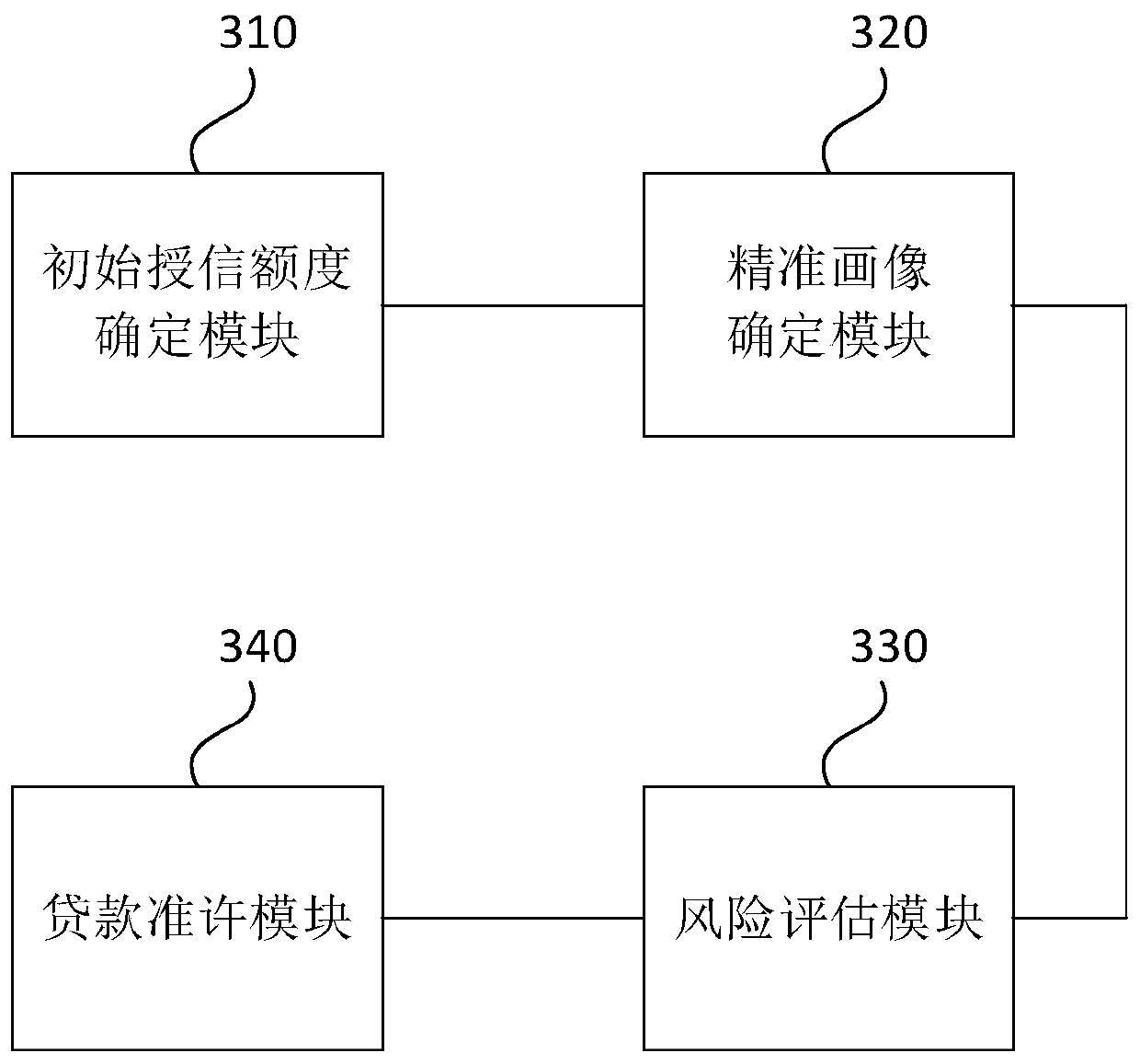

Enterprise loan automatic approval method and device, storage medium and electronic device

The embodiment of the invention discloses an enterprise loan automatic approval method and device, a storage medium and an electronic device. The method comprises the steps of determining an initial credit line of a target enterprise according to credit investigation information of the target enterprise; wherein the credit investigation information comprises at least one of daily average deposit,enterprise tax payment, salary pay-for-another and receivable money; collecting verification reference information of the target enterprise, and determining an accurate portrait of the target enterprise; approving the credit investigation information and the accurate portrait of the target enterprise by using a pre-trained approval rule base; if approval is passed, performing risk assessment on the target enterprise by adopting a risk assessment model; and if the evaluation meets the preset standard, determining that loan is allowed to be carried out according to the initial credit line. By implementing the technical scheme, the effect of issuing loans to enterprises in an automatic approval mode can be achieved, and the economic problem in enterprise development is solved. Meanwhile, strict risk management and control are also achieved, and stable development of economy is promoted.

Owner:CHINA CONSTRUCTION BANK

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com