Credit levying business system

A business system and business technology, applied in the field of credit services, can solve the problems of many banks with credit lines, insufficient risk identification and control capabilities of small and medium-sized enterprises, and difficulty in financing small and medium-sized enterprises.

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

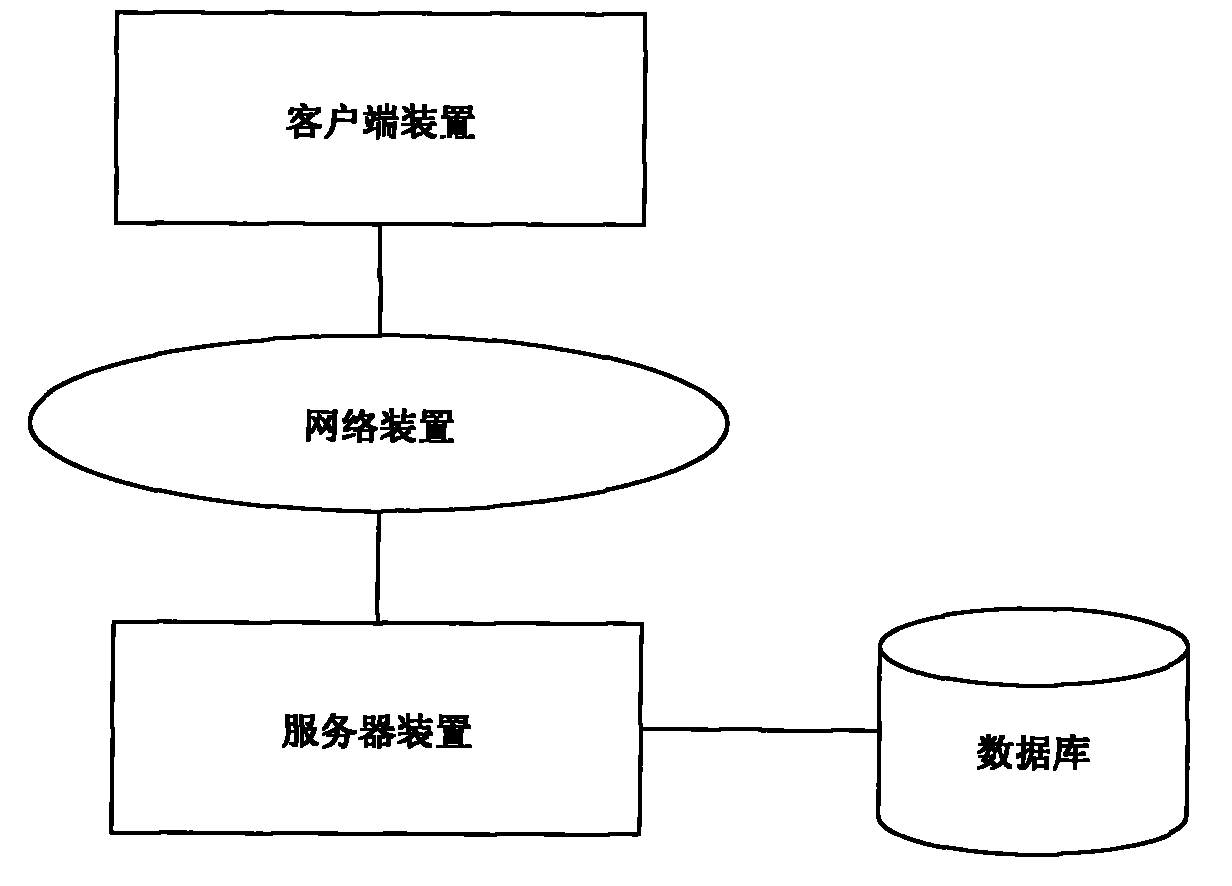

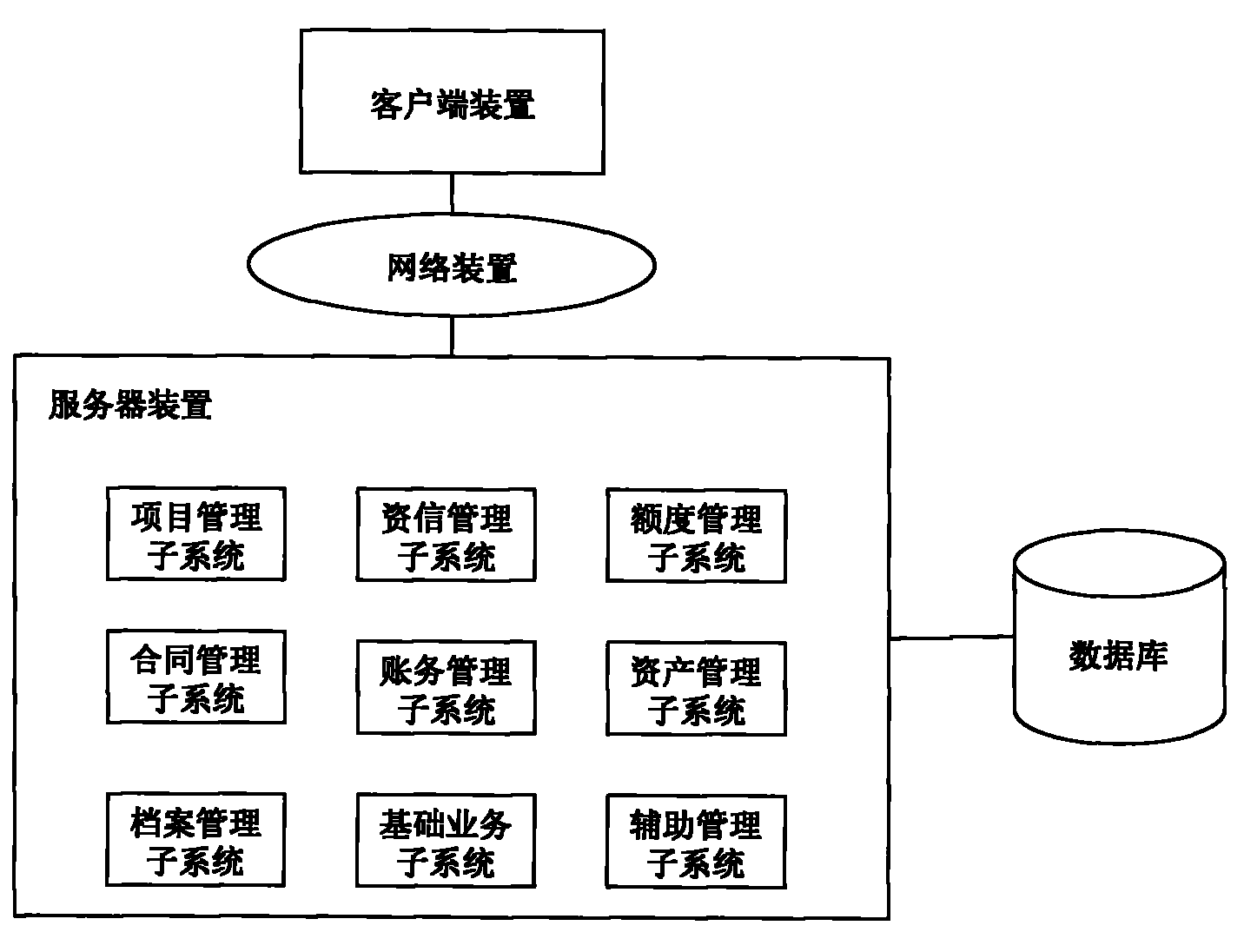

[0051] The present invention discloses a credit service system, such as figure 1 As shown, the credit service system is composed of a client device, a network device, a server device, a data bus and a database. The client device is connected to the server device through the network device, and the server device is connected to the database through the data bus.

[0052] in:

[0053] The client device is the user's operating console. The user accesses each subsystem in the server device through the client device, and fills in data on the functional interface of the subsystem. After the client device receives the data, it sends it to the server device through the network device and delivers it to System components perform processing, and receive and display the results of the processing.

[0054] The server device is the carrying platform of the processing components, the system components are all installed on the server, and the subsystem operates in the computing environment ...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com