Patents

Literature

664 results about "Payment service provider" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

A payment service provider (PSP) offers shops online services for accepting electronic payments by a variety of payment methods including credit card, bank-based payments such as direct debit, bank transfer, and real-time bank transfer based on online banking. Typically, they use a software as a service model and form a single payment gateway for their clients (merchants) to multiple payment methods.

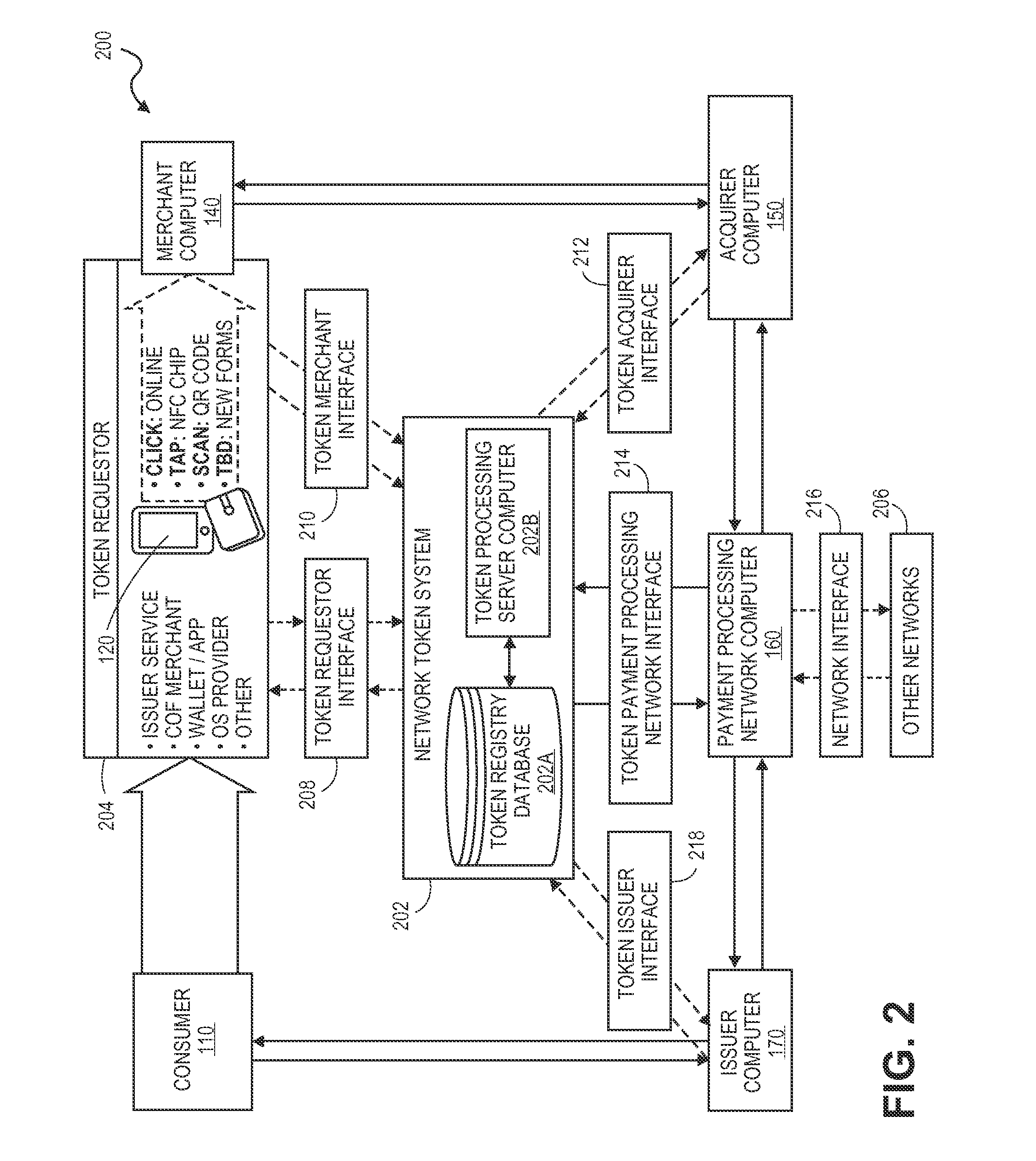

Systems and methods for communicating token attributes associated with a token vault

ActiveUS20150032627A1Convenient transactionSupported interoperabilityFinanceUser identity/authority verificationThird partyPayment transaction

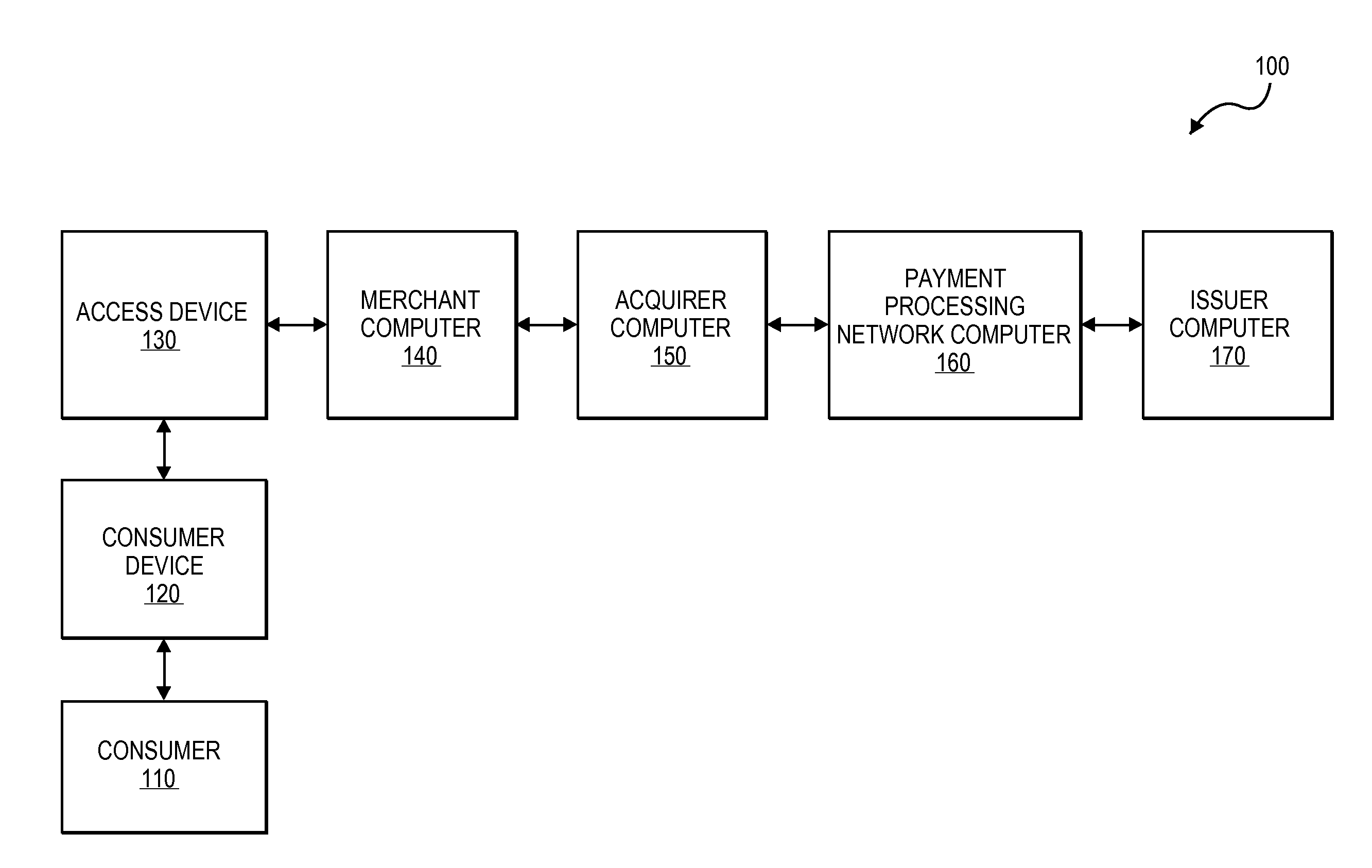

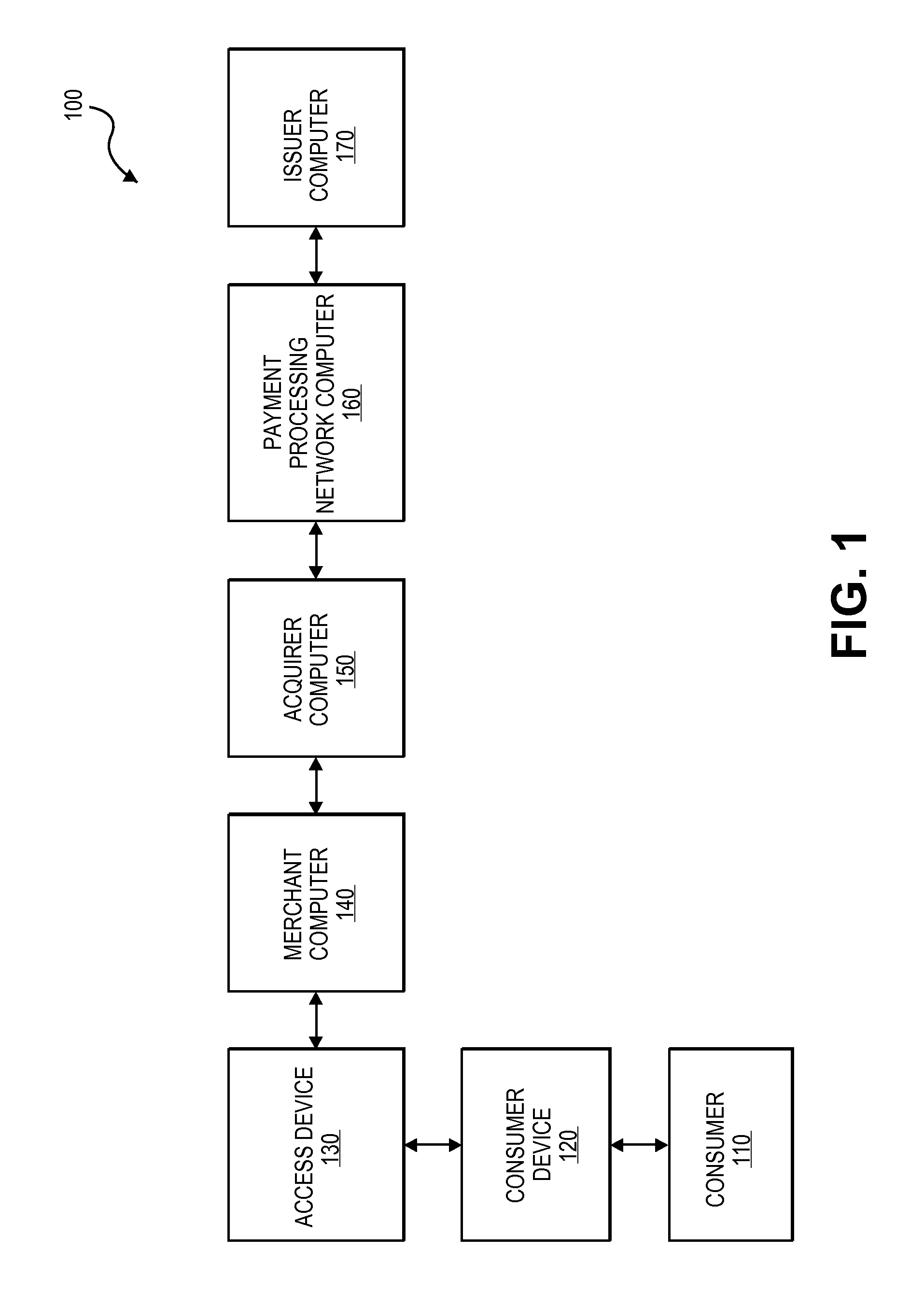

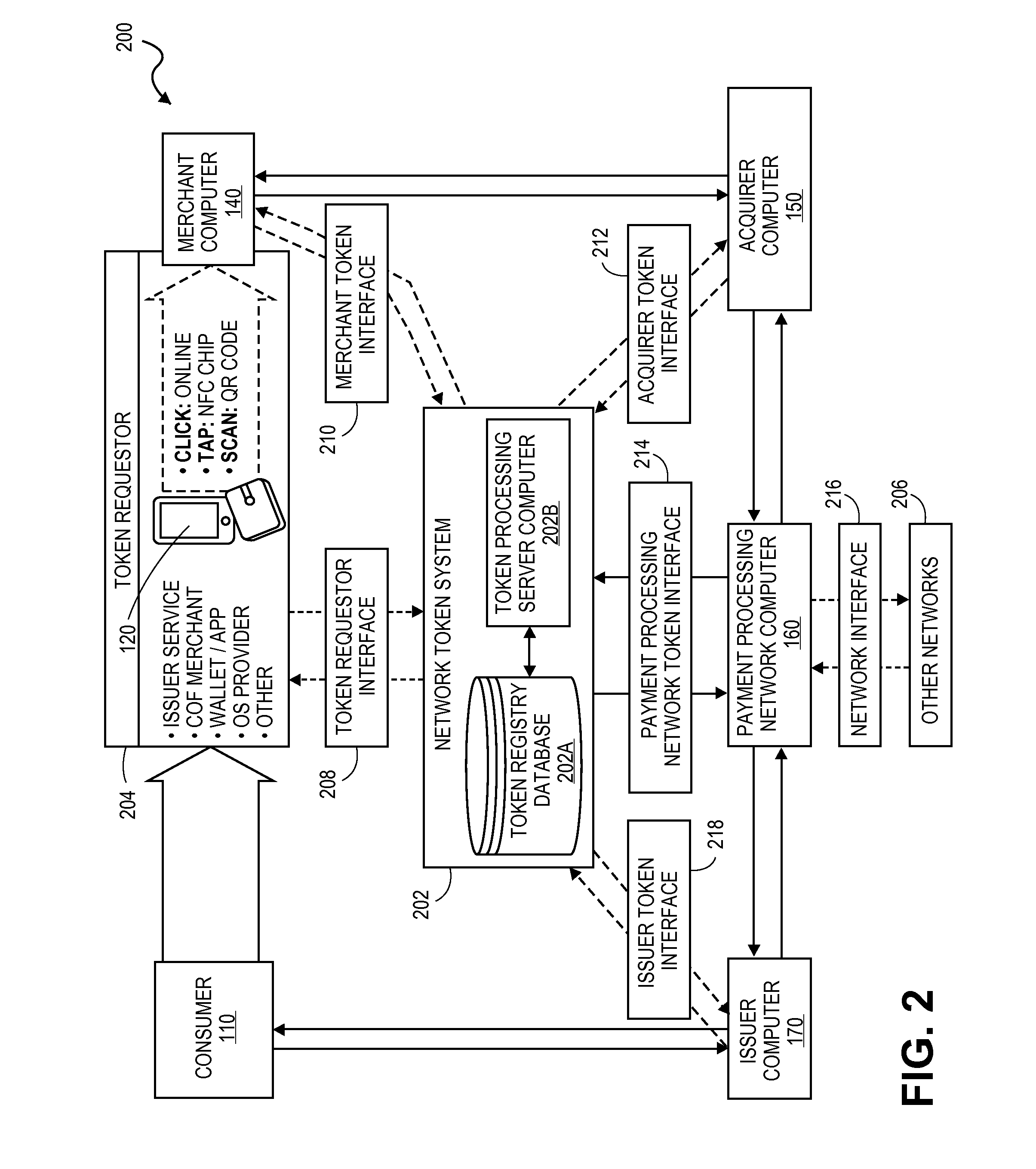

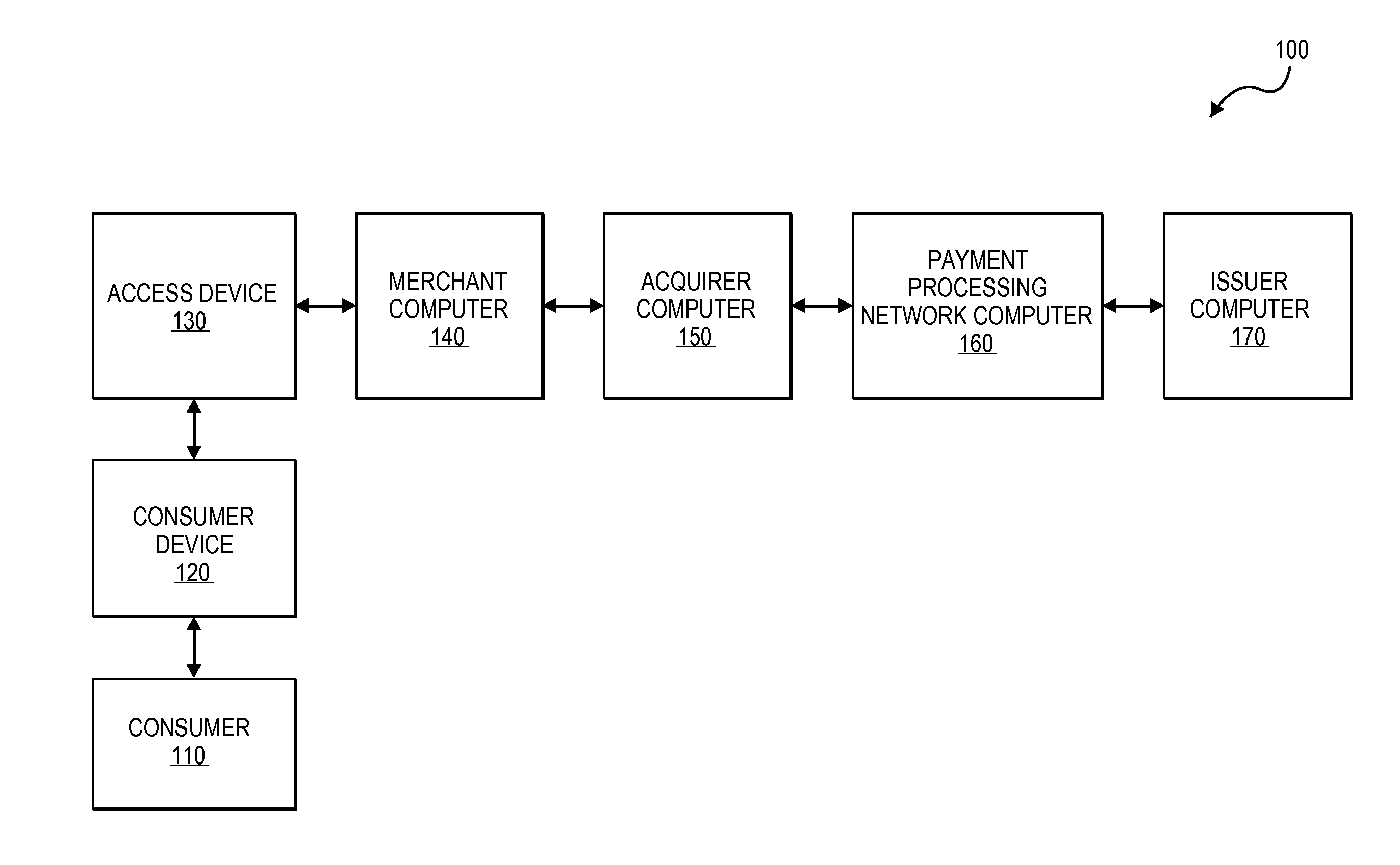

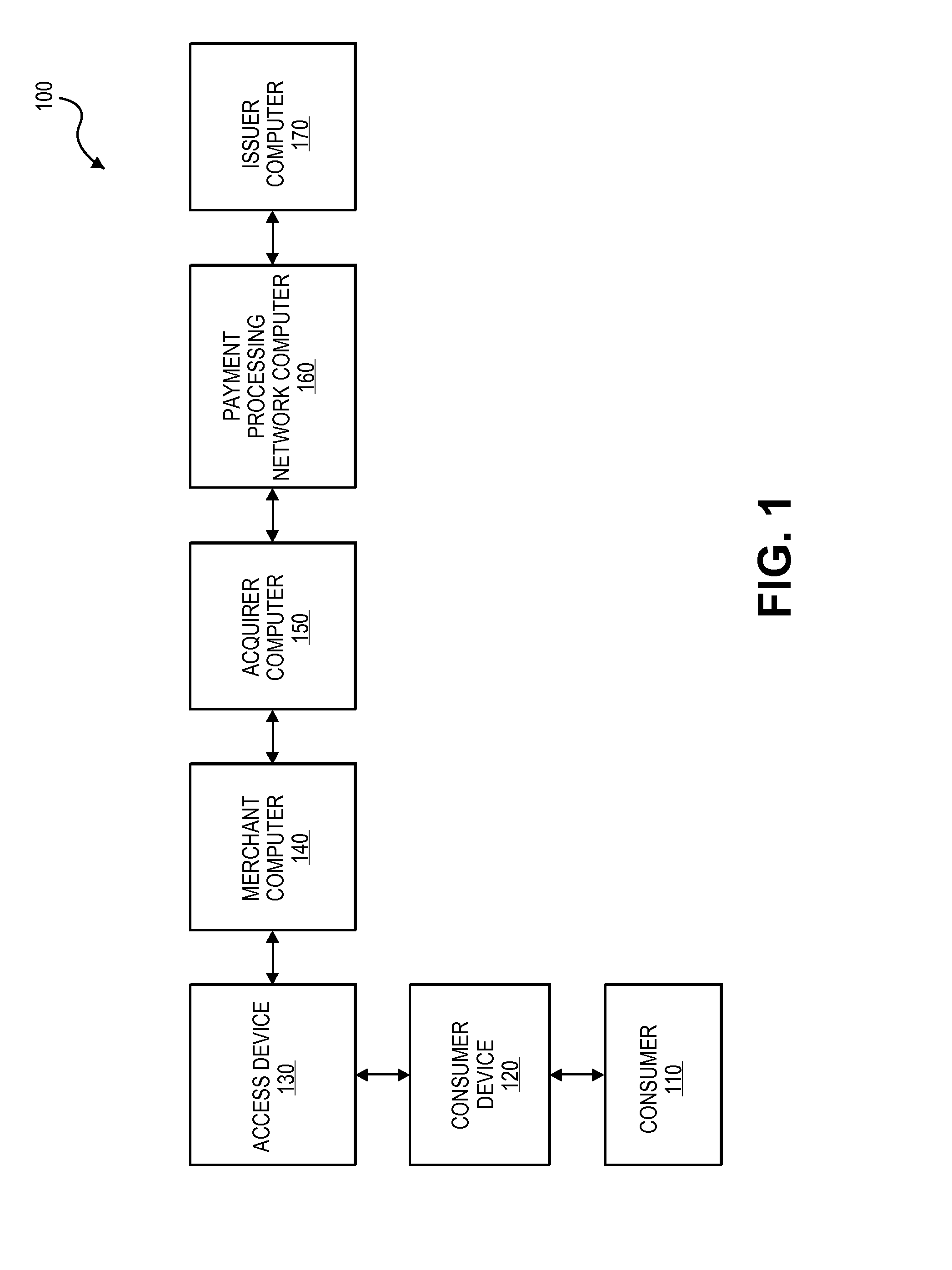

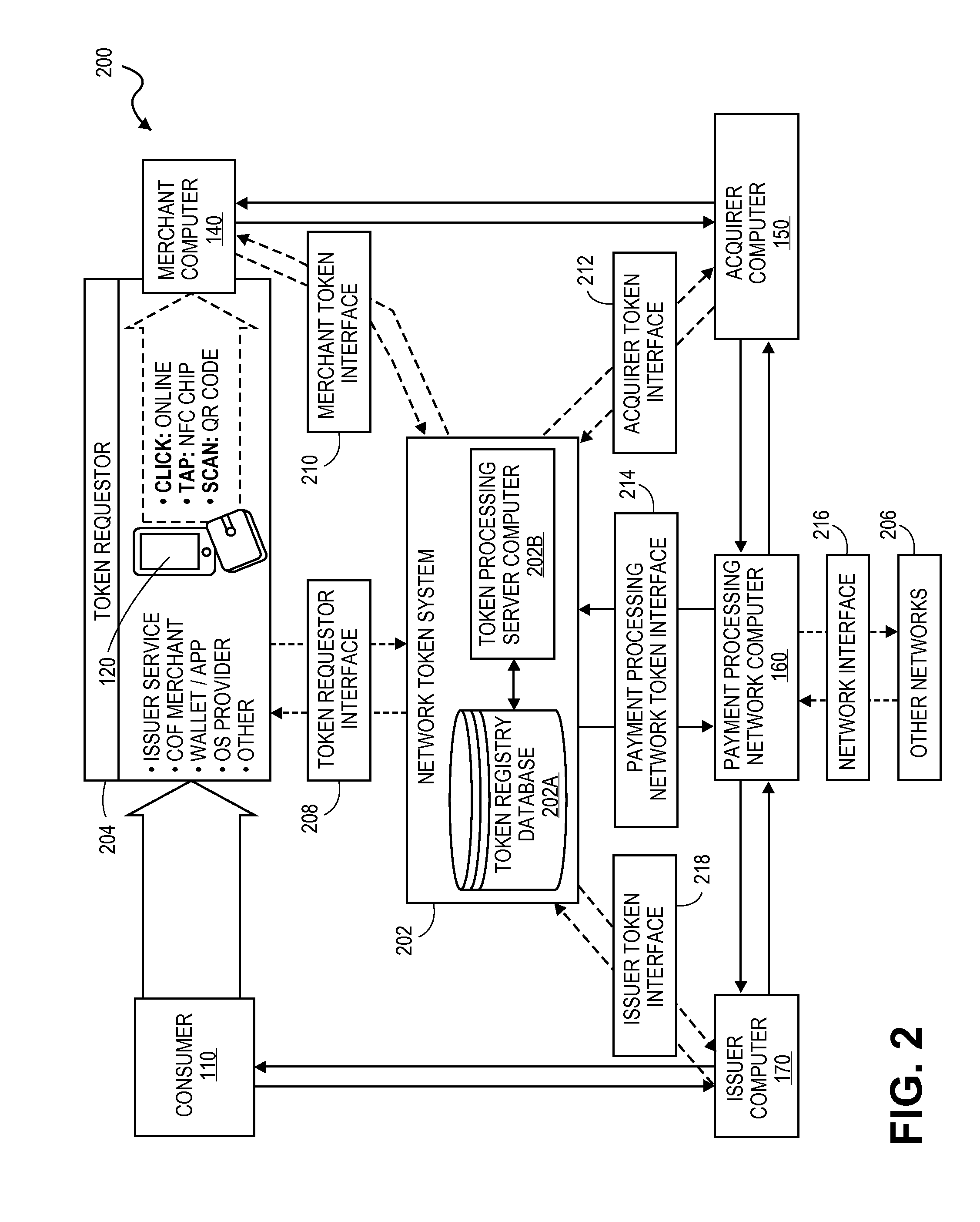

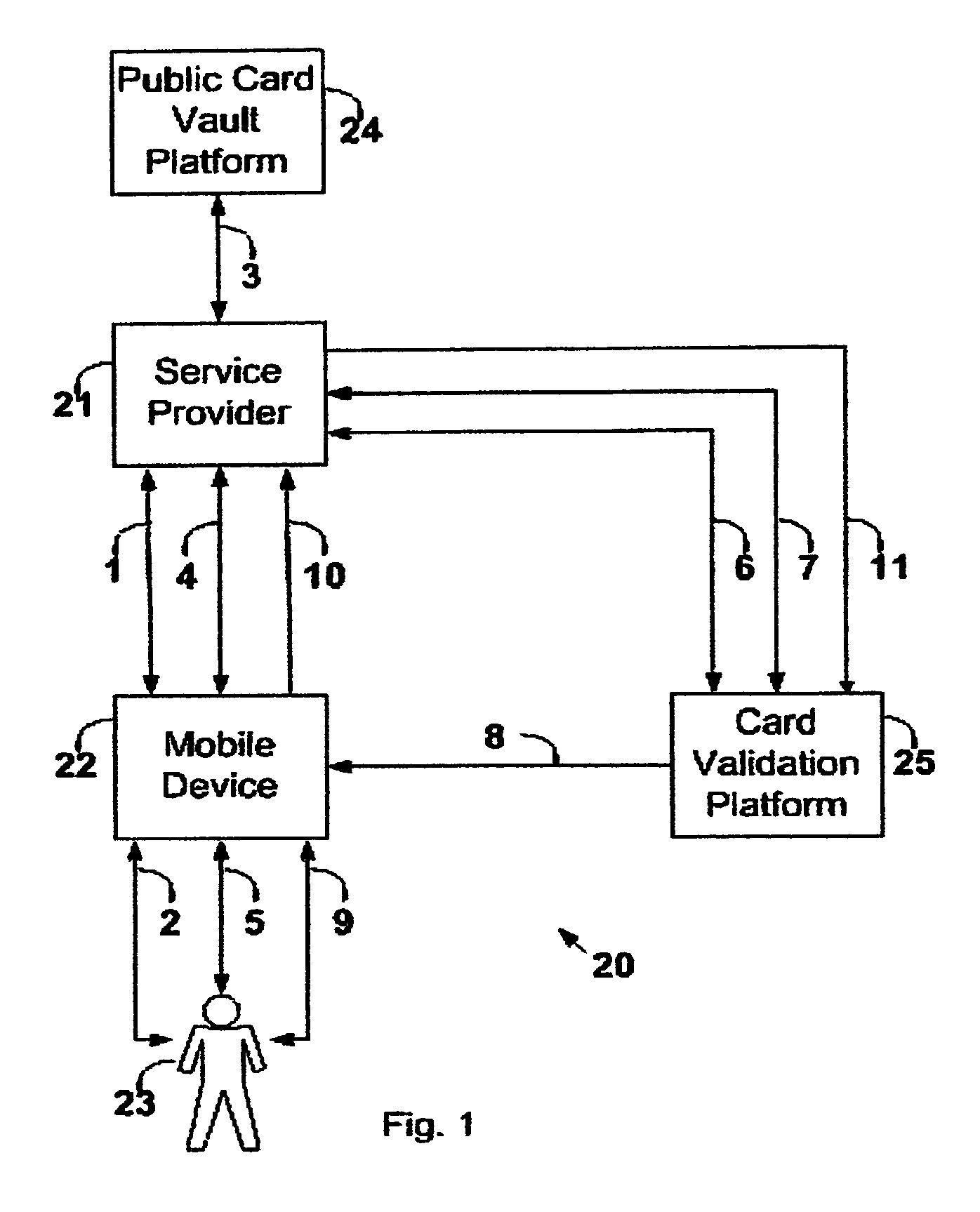

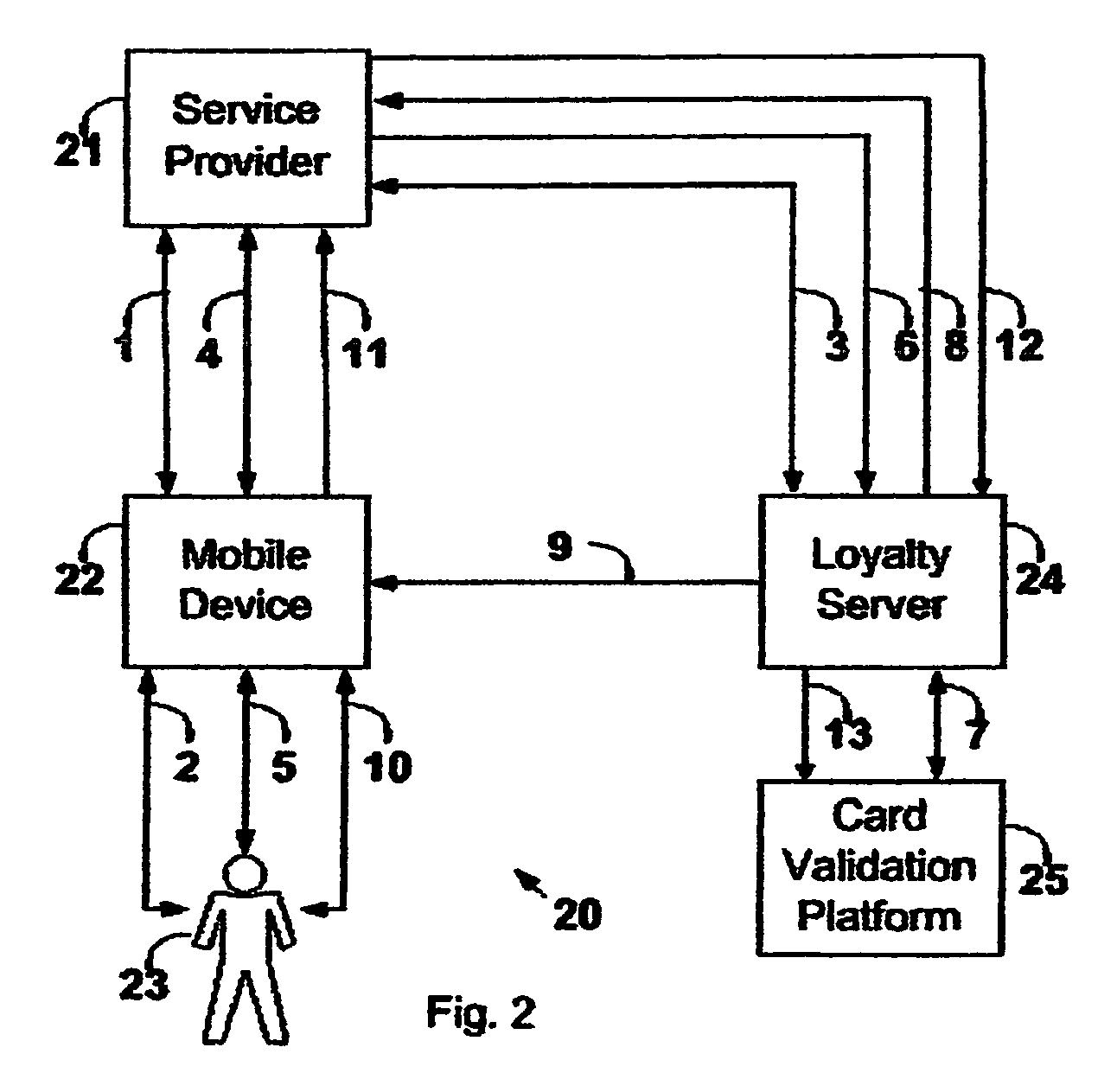

Systems and methods for interoperable network token processing are provided. A network token system provides a platform that can be leveraged by external entities (e.g., third party wallets, e-commerce merchants, payment enablers / payment service providers, etc.) or internal payment processing network systems that have the need to use the tokens to facilitate payment transactions. A token registry vault can provide interfaces for various token requestors (e.g., mobile device, issuers, merchants, mobile wallet providers, etc.), merchants, acquirers, issuers, and payment processing network systems to request generation, use and management of tokens. The network token system further provides services such as card registration, token generation, token issuance, token authentication and activation, token exchange, and token life-cycle management.

Owner:VISA INT SERVICE ASSOC

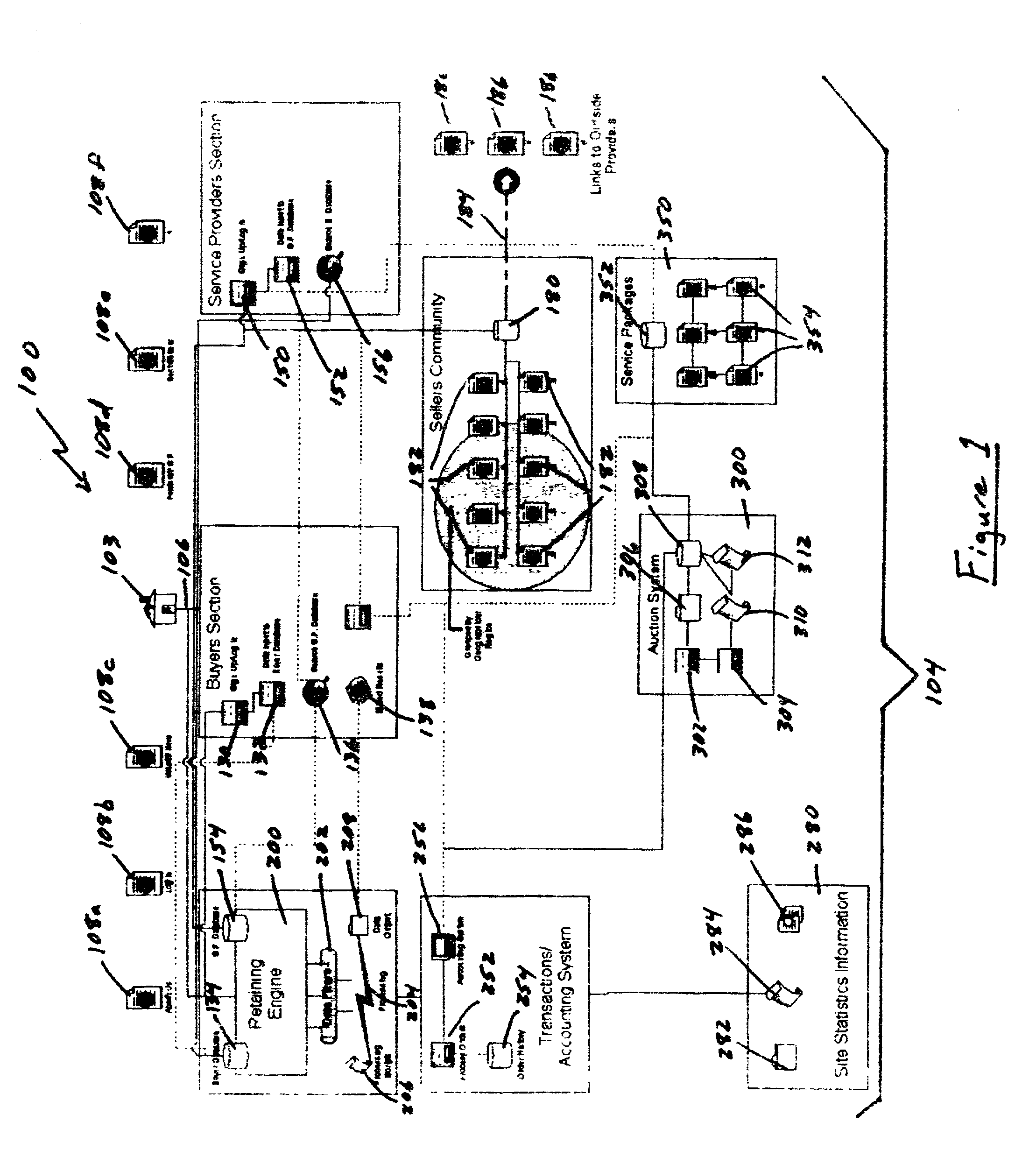

Auction, imagery and retaining engine systems for services and service providers

InactiveUS20020120554A1Facilitates in efficiently accessing latent demandEliminate riskFinancePayment architectureGroup PurchasingService provision

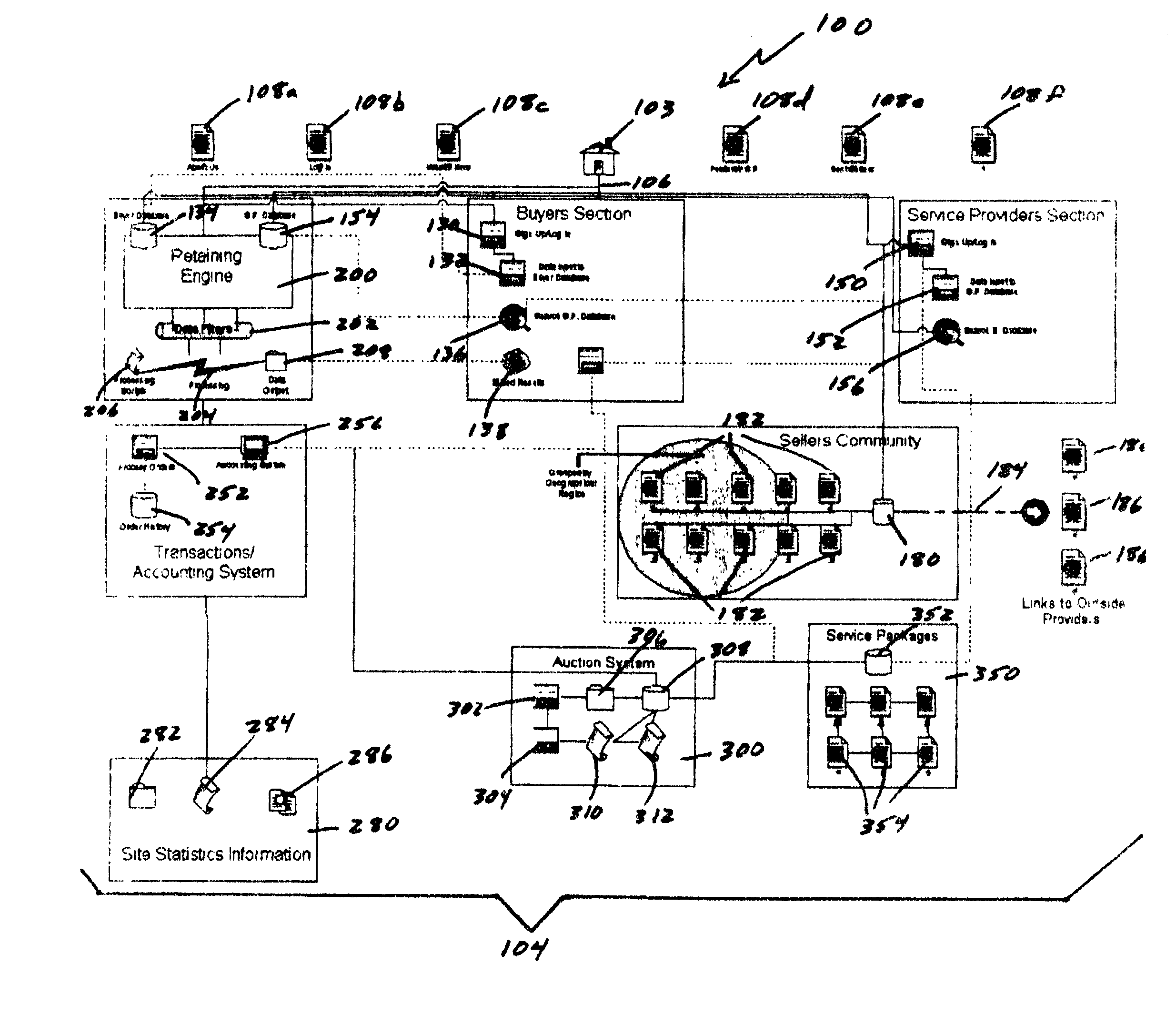

The present disclosure provides a computer-implemented method / system for facilitating communications between service providers and potential customers for services. The computer-implemented method / system provides a marketplace for interactions, both online and off-line, between service providers and potential customers, including purchasing groups, particularly buyer-driven service-related interactions. The marketplace advantageously allows categorization, key word searching, group purchasing, service packaging, data mining, auctions and other commercial features and functionality. The computer-implemented method / system also supports holographic imagery, e.g., in the form of virtual assistants, that facilitates marketplace-related activities. Based on the computer-implemented method / system, service providers are able to efficiently and cost effectively extend the reach of their marketing and promotional activities to a wide range of additional customers, and customers are able to initiate access service providers ideally suited to meet their needs, i.e., buyer-driven commerce, at desirable prices and according to required timeframes.

Owner:VEGA LILLY MAE

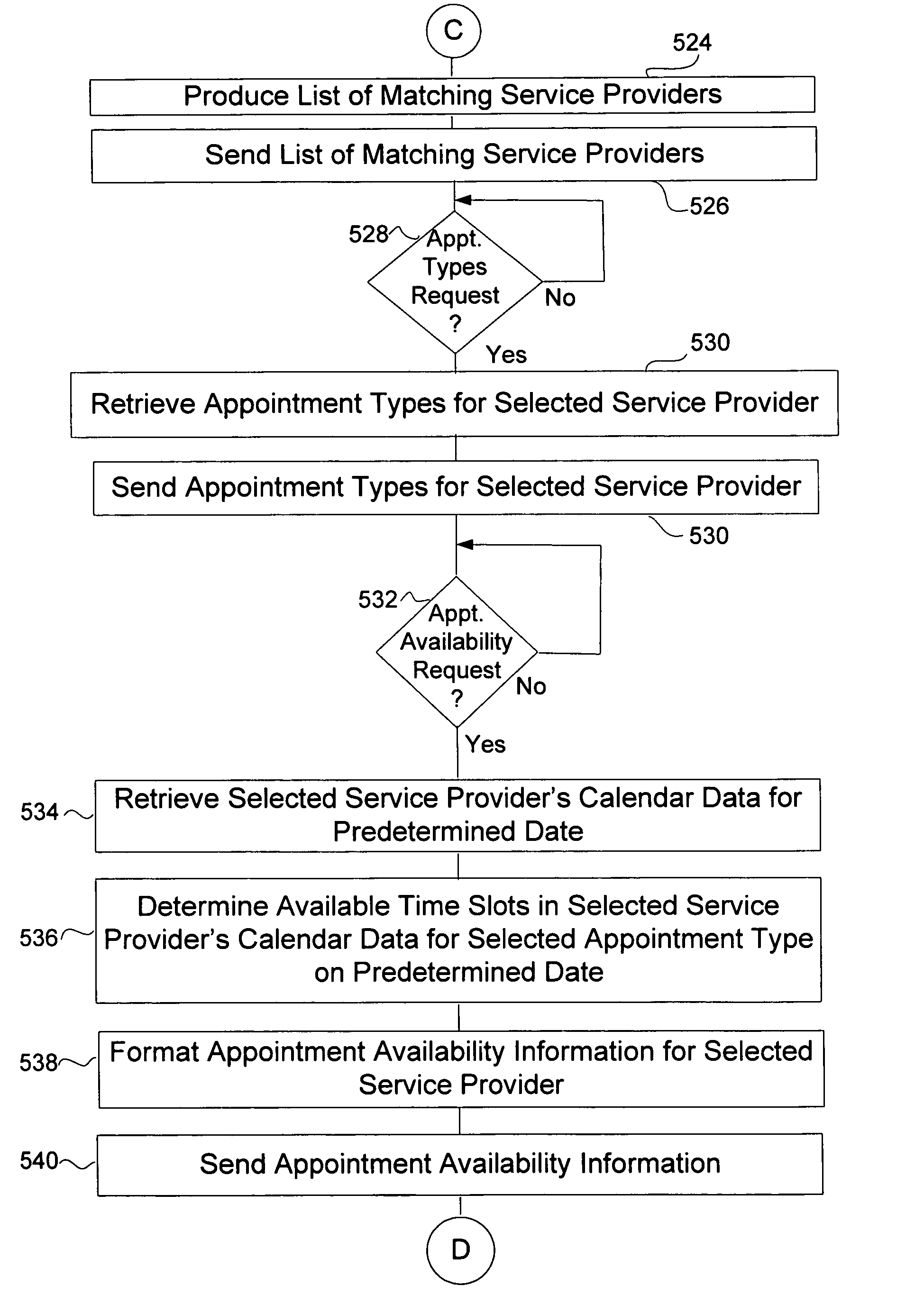

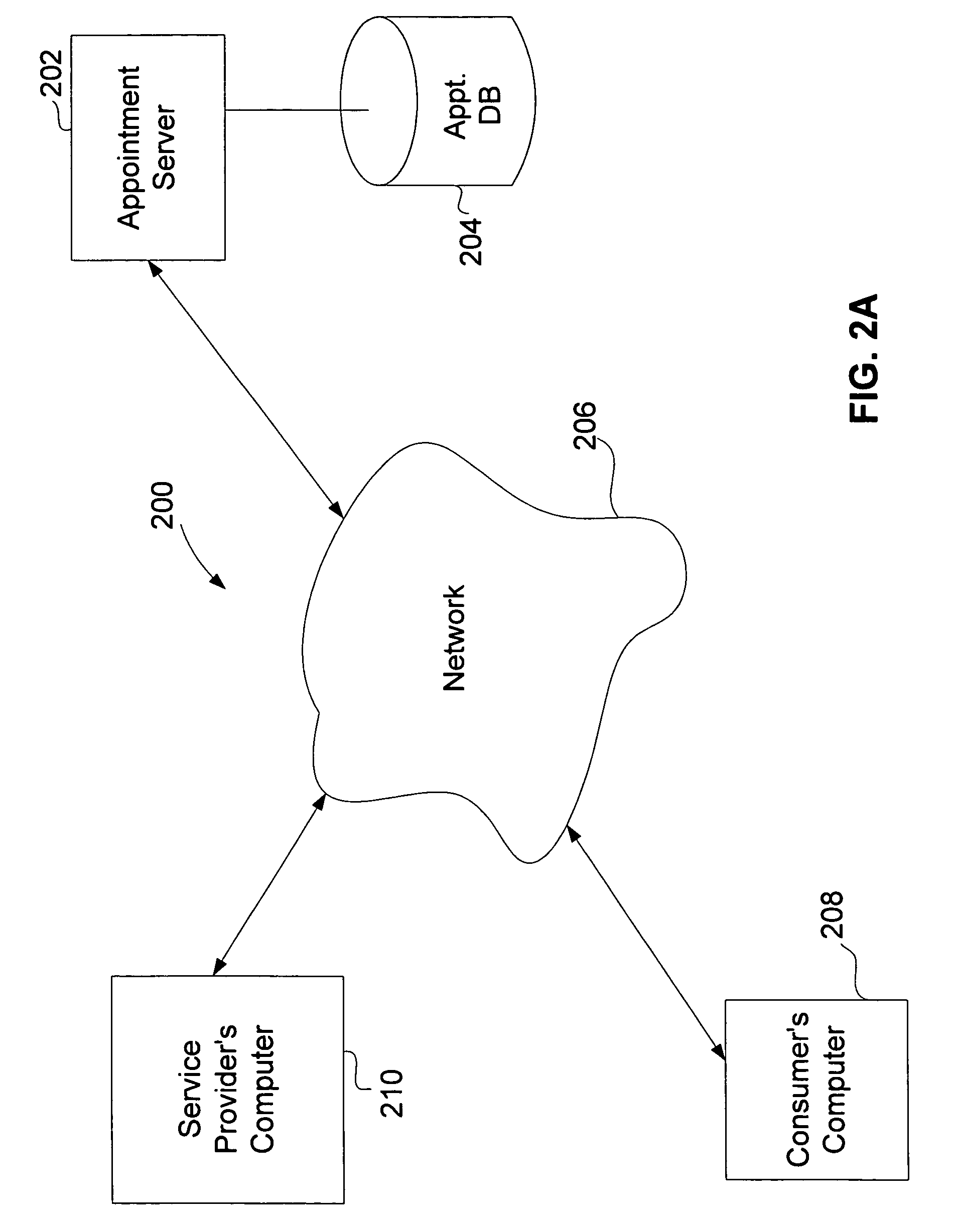

On-line appointment system with electronic notifications

InactiveUS7188073B1Efficiently establishedReservationsDigital computer detailsThe InternetImproved method

Improved approaches to providing on-line appointments over a network are disclosed. The network is, for example, a global computer network such as the Internet. One of the improved approaches provides various notifications to requestors pertaining to appointments with individuals or businesses (e.g., service providers). In one implementation, the notifications can be provided by electronic mail. Another of the improved approaches allows notifications pertaining to requested appointments to be provided to service providers that have not previously registered to receive on-line appointments.

Owner:RATEZE REMOTE MGMT LLC

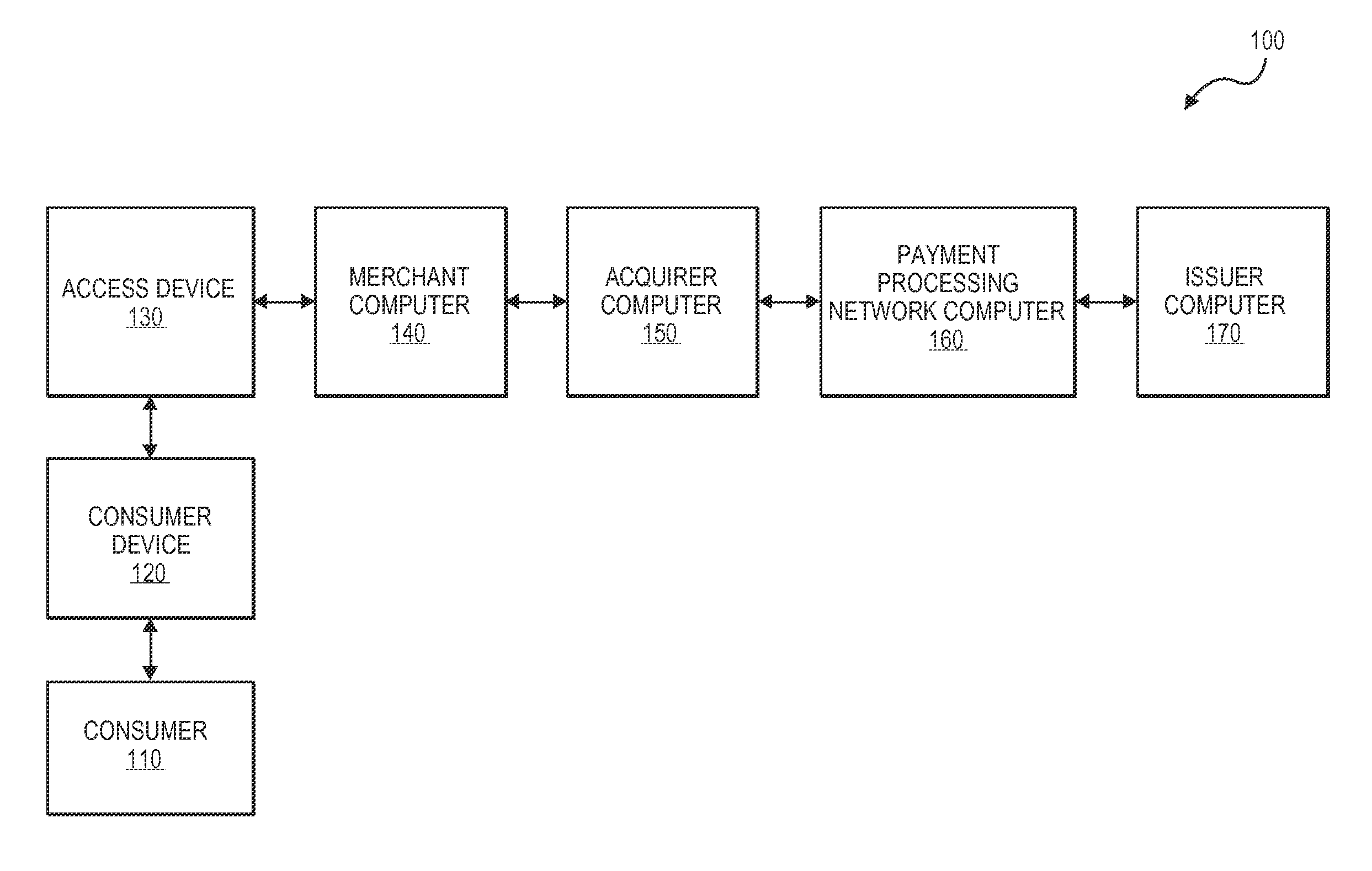

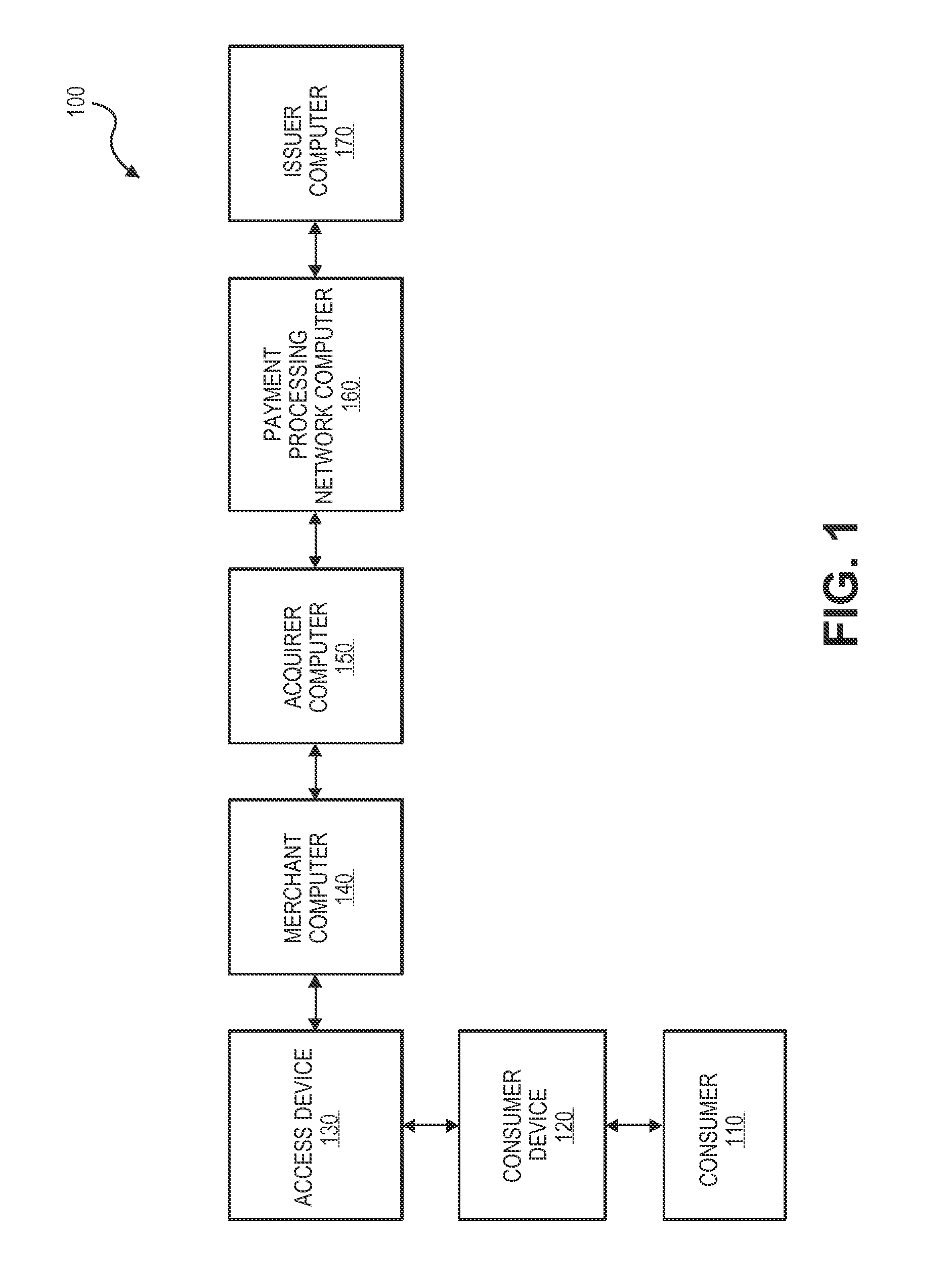

Systems and methods for communicating risk using token assurance data

InactiveUS20150032625A1Easy to optimizeFinanceUser identity/authority verificationThird partyPayment transaction

Systems and methods for communicating risk using token assurance data are provided. A network token system provides a platform that can be leveraged by external entities (e.g., third party wallets, e-commerce merchants, payment enablers / payment service providers, etc.) or internal payment processing network systems that have the need to use the tokens to facilitate payment transactions. An authorization request message can include a token assurance level code that is indicative of a token assurance level associated with a generated token. External or internal entities may use the token assurance level to evaluate risk associated with a payment transaction that uses the token.

Owner:VISA INT SERVICE ASSOC

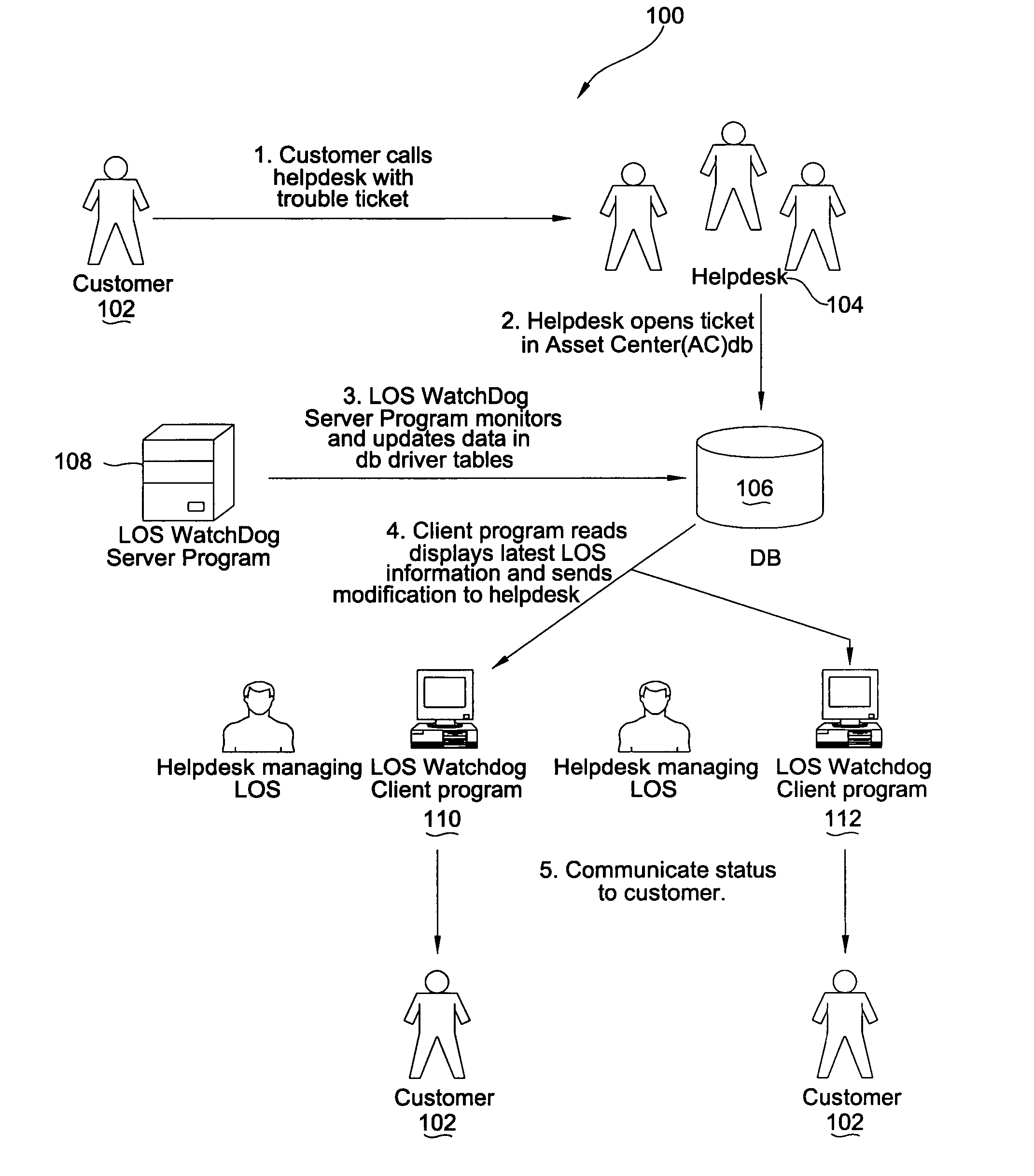

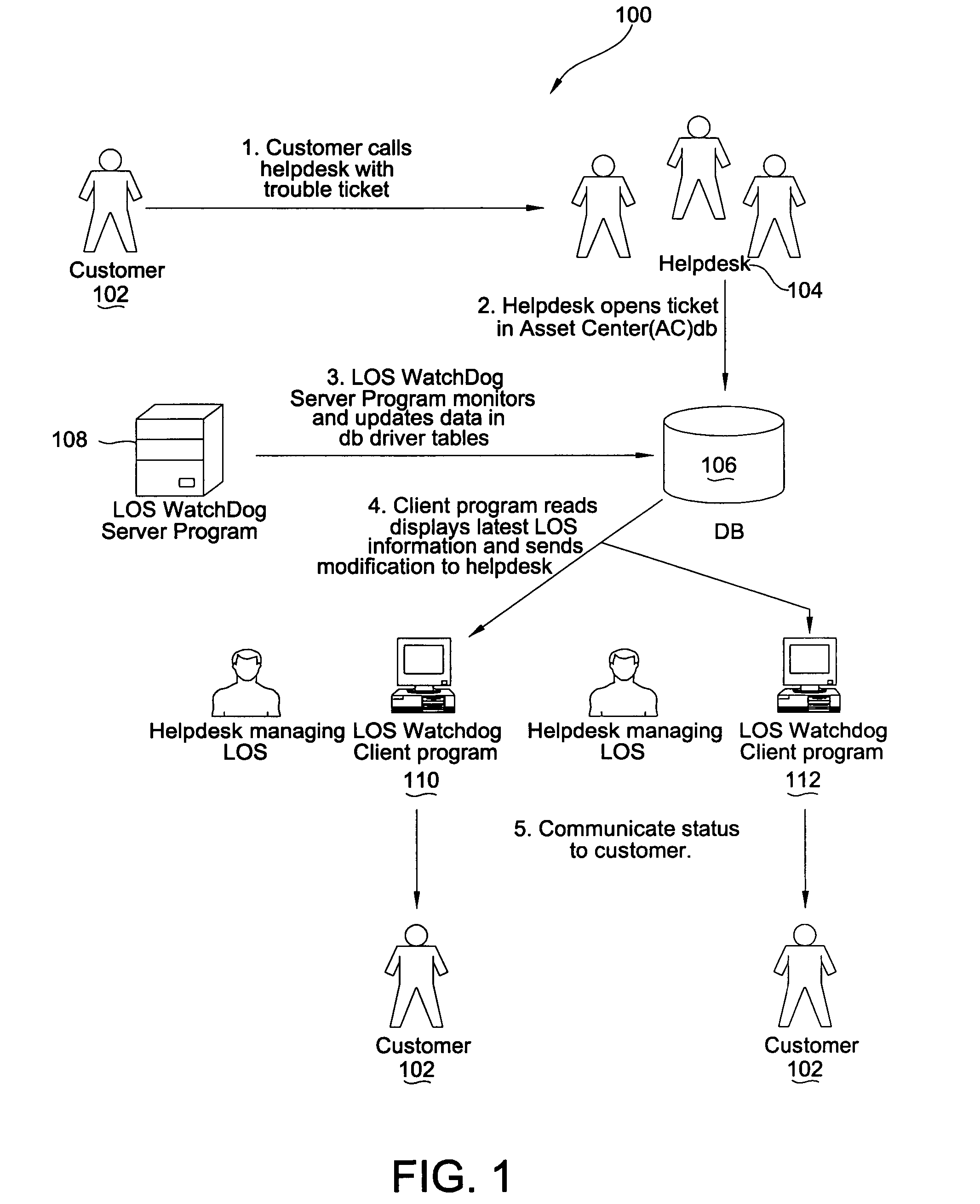

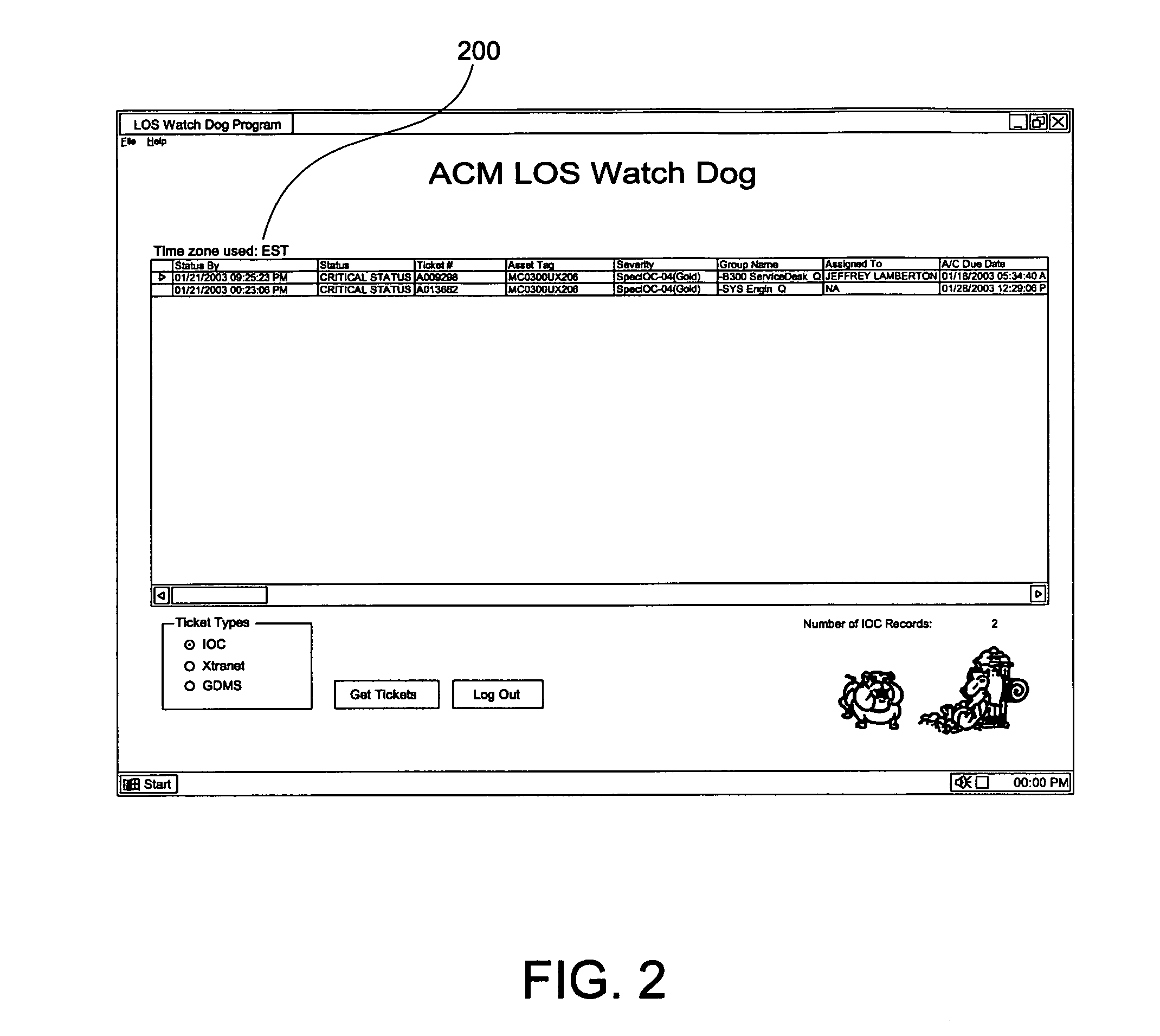

Information technology service request level of service monitor

A method, system, and computer program product for monitoring service tickets for information technology (IT) service providers to ensure that levels of service regarding resolving problems identified by a customer are met is provided. In one embodiment, a monitoring server inspects a service ticket in a database to determine a deadline for when a problem associated with the service ticket must be resolved. The server then determines a deadline approaching alert time. This deadline approaching alert time is a time at which a help desk user must be notified that the deadline for resolving the problem must be met is approaching. The server then alerts the help desk user that the deadline for resolving the problem is approaching when the deadline approaching alert time is reached. If the problem is not resolved by the deadline, the server periodically alerts the help desk user when times for status updates, which have been specified by a level of service agreement for updating the customer of the status of resolution of problems that have past deadline, are approaching, thereby ensuring that the IT provider meets its obligations to the customer.

Owner:HEWLETT-PACKARD ENTERPRISE DEV LP

Systems and methods for interoperable network token processing

InactiveUS20150032626A1Easy to optimizeSupported interoperabilityFinanceUser identity/authority verificationPayment transactionPayment service provider

Systems and methods for interoperable network token processing are provided. A network token system provides a platform that can be leveraged by external entities (e.g., third party wallets, e-commerce merchants, payment enablers / payment service providers, etc.) or internal payment processing network systems that have the need to use the tokens to facilitate payment transactions. A token registry vault can provide interfaces for various token requestors (e.g., mobile device, issuers, merchants, mobile wallet providers, etc.), merchants, acquirers, issuers, and payment processing network systems to request generation, use and management of tokens. The network token system further provides services such as card registration, token generation, token issuance, token authentication and activation, token exchange, and token life-cycle management.

Owner:VISA INT SERVICE ASSOC

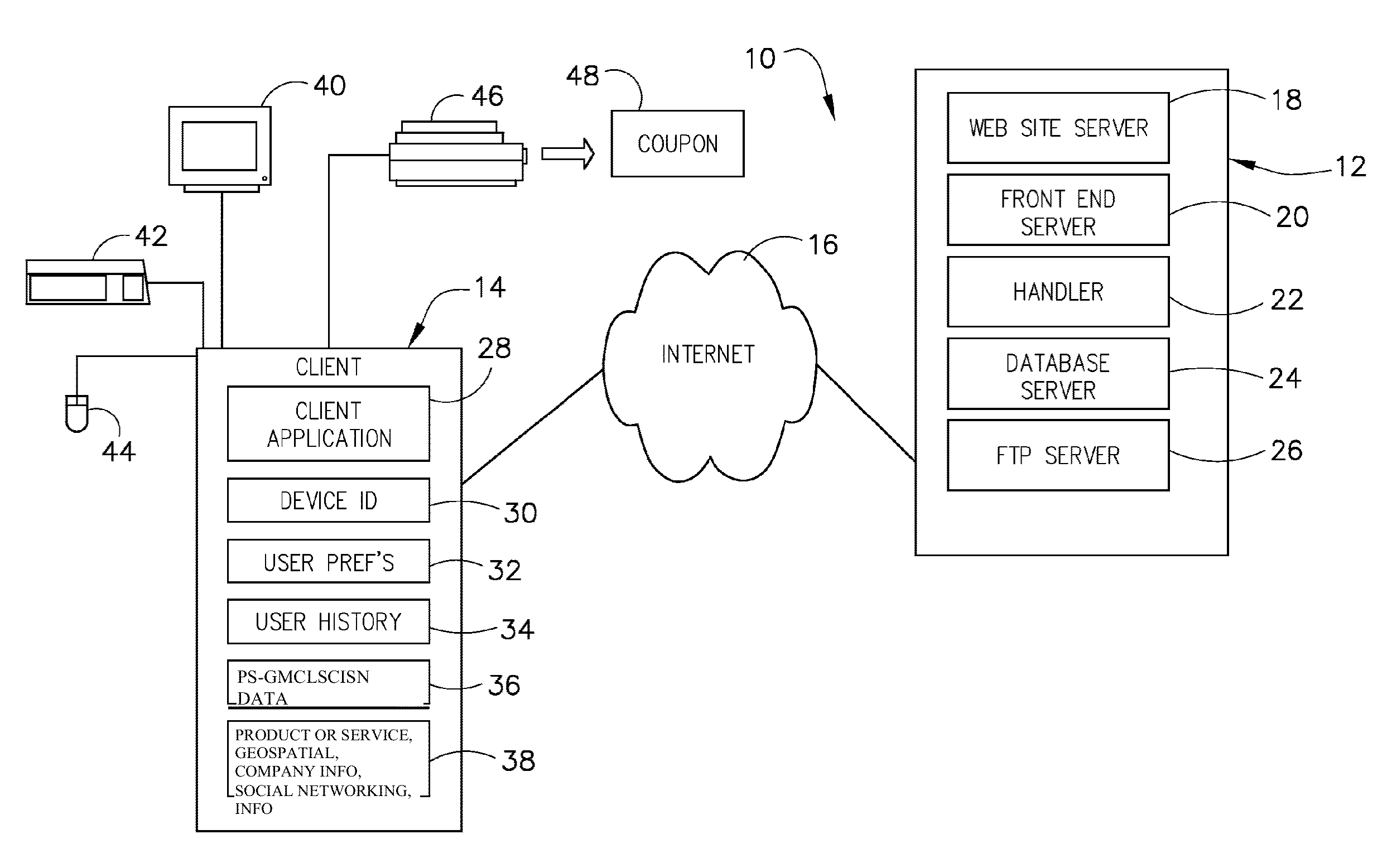

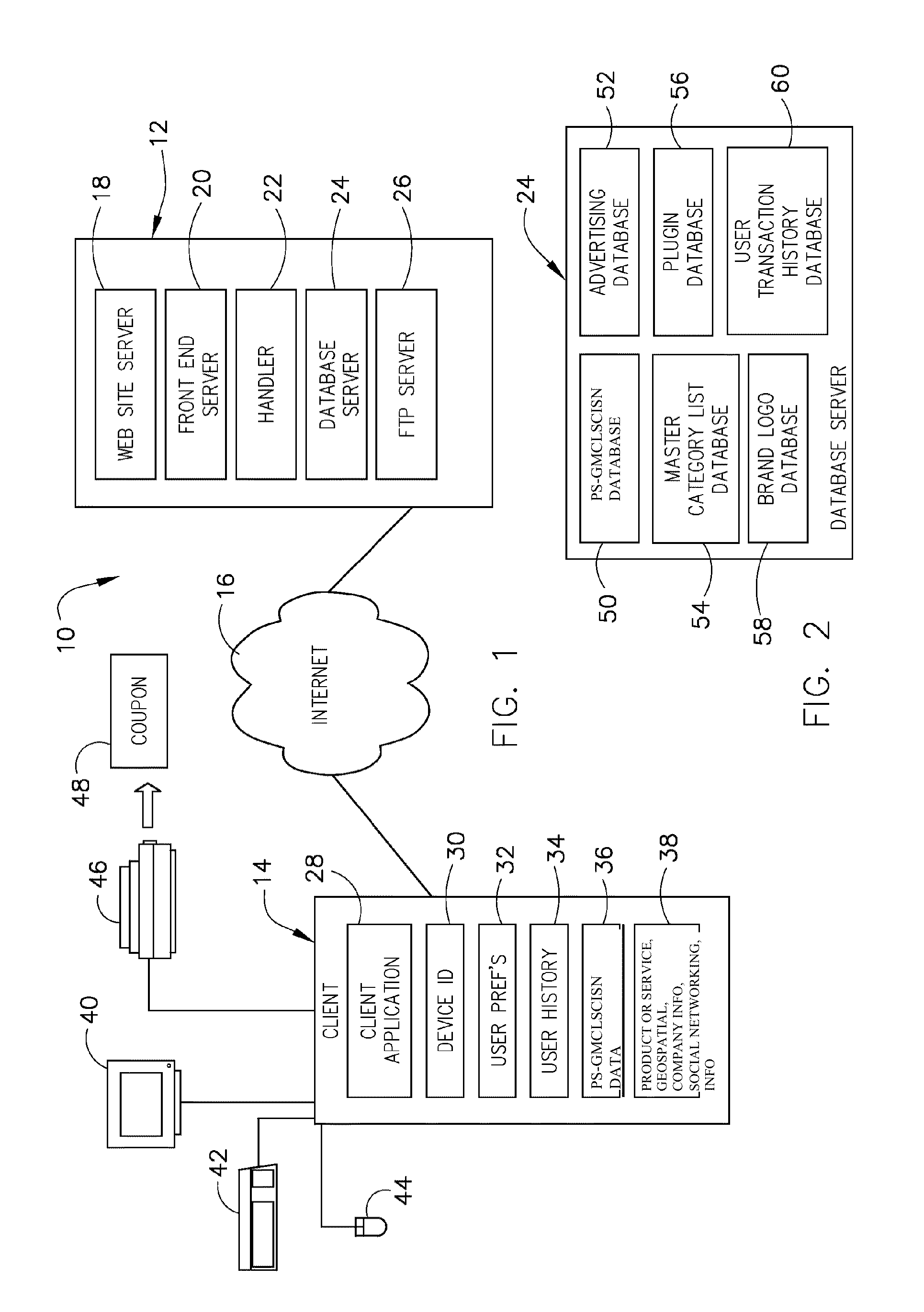

System and method for tracking, utilizing predicting, and implementing online consumer browsing behavior, buying patterns, social networking communications, advertisements and communications, for online coupons, products, goods & services, auctions, and service providers using geospatial mapping technology, and social networking

InactiveUS20130073366A1Efficient and economicalCheaply obtain dataMarketingPayment service providerMobile service

Systems and methods are provided for combined social behavior tracking, online surveillance and web bot software technologies via a mobile device or computer for tracking online consumer behavior and data, cookies, embedded advertisements, predicting online consumer behavior, buying patterns by monitoring online activities, online communications, search inquiries, social networking, social plugins, social applications, advertisements, purchasing, behavior, and buying patterns, consumer address books and contact lists, blogs, chat rooms, friends, acquaintances and strangers, instant messaging, text chat, internet forum, service providers, travel and hospitality, real estate, educational services, ancillary services (as defined herein) and delivery system for behavior targeting and filtering of coupons, mobile services, products, goods and services, advertisements and service providers and related company information on a three dimensional geospatial platform using multi-dimensional and scalable geospatial mapping associated with entities providing and / or members of the service and / or social networking.

Owner:HEATH STEPHAN

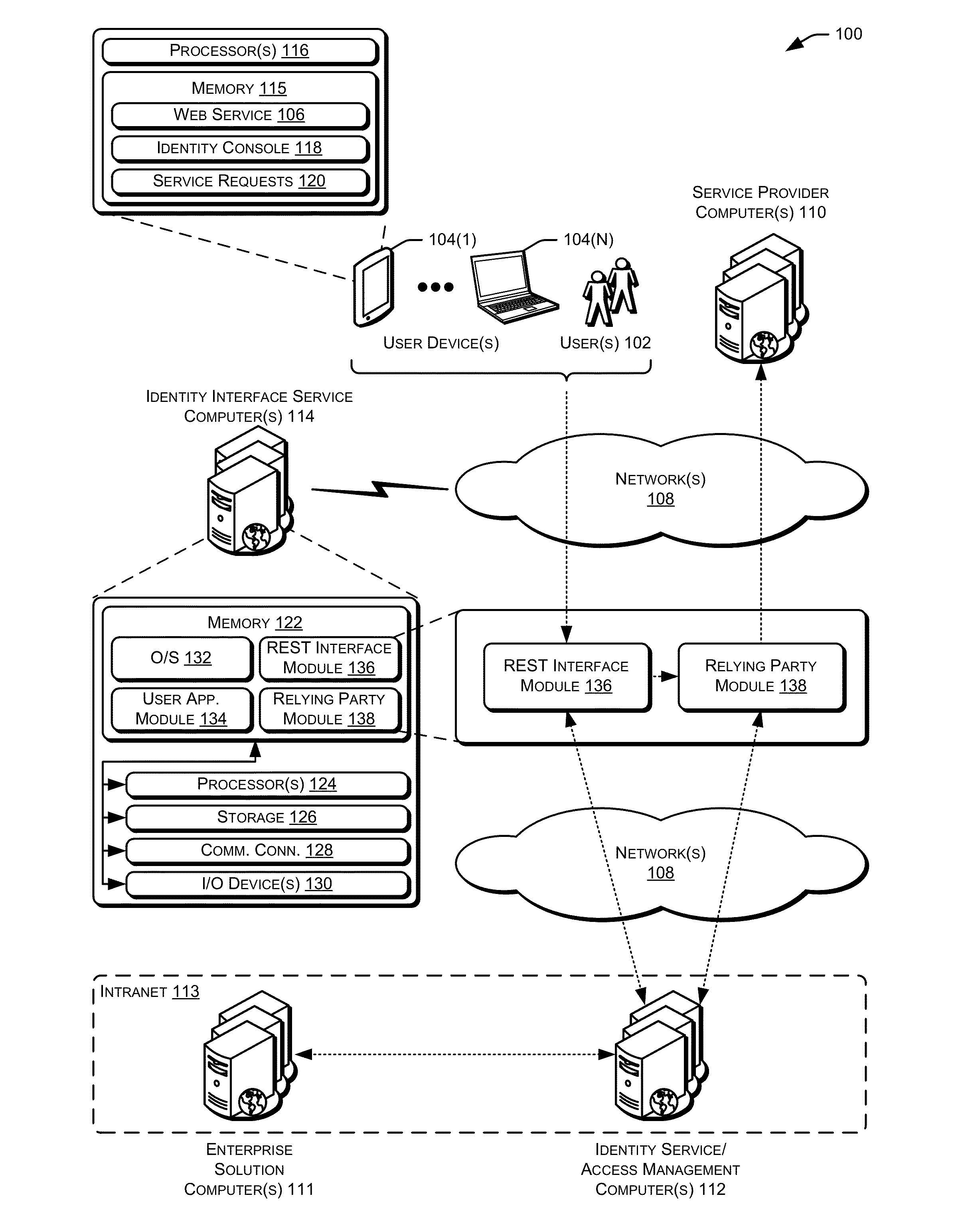

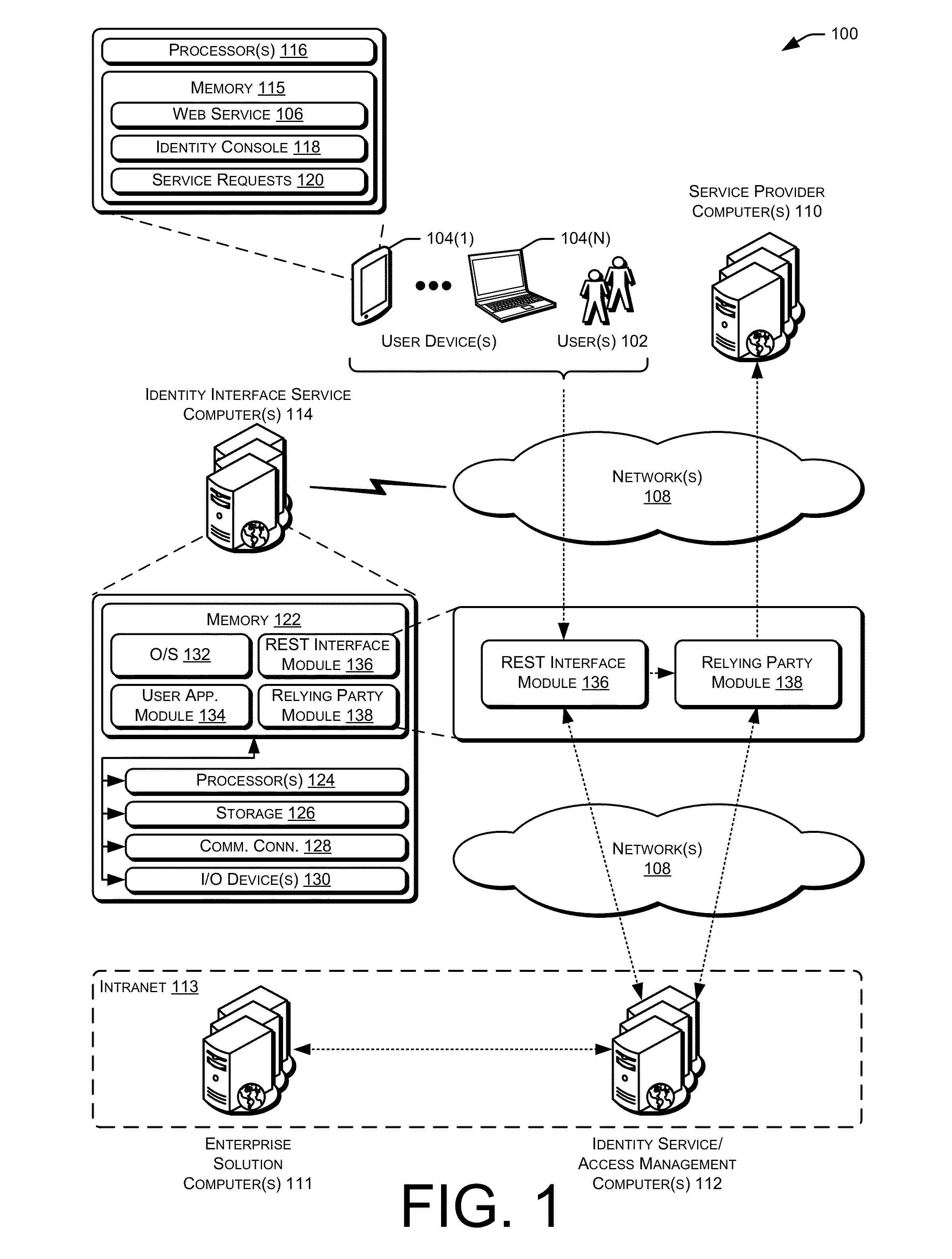

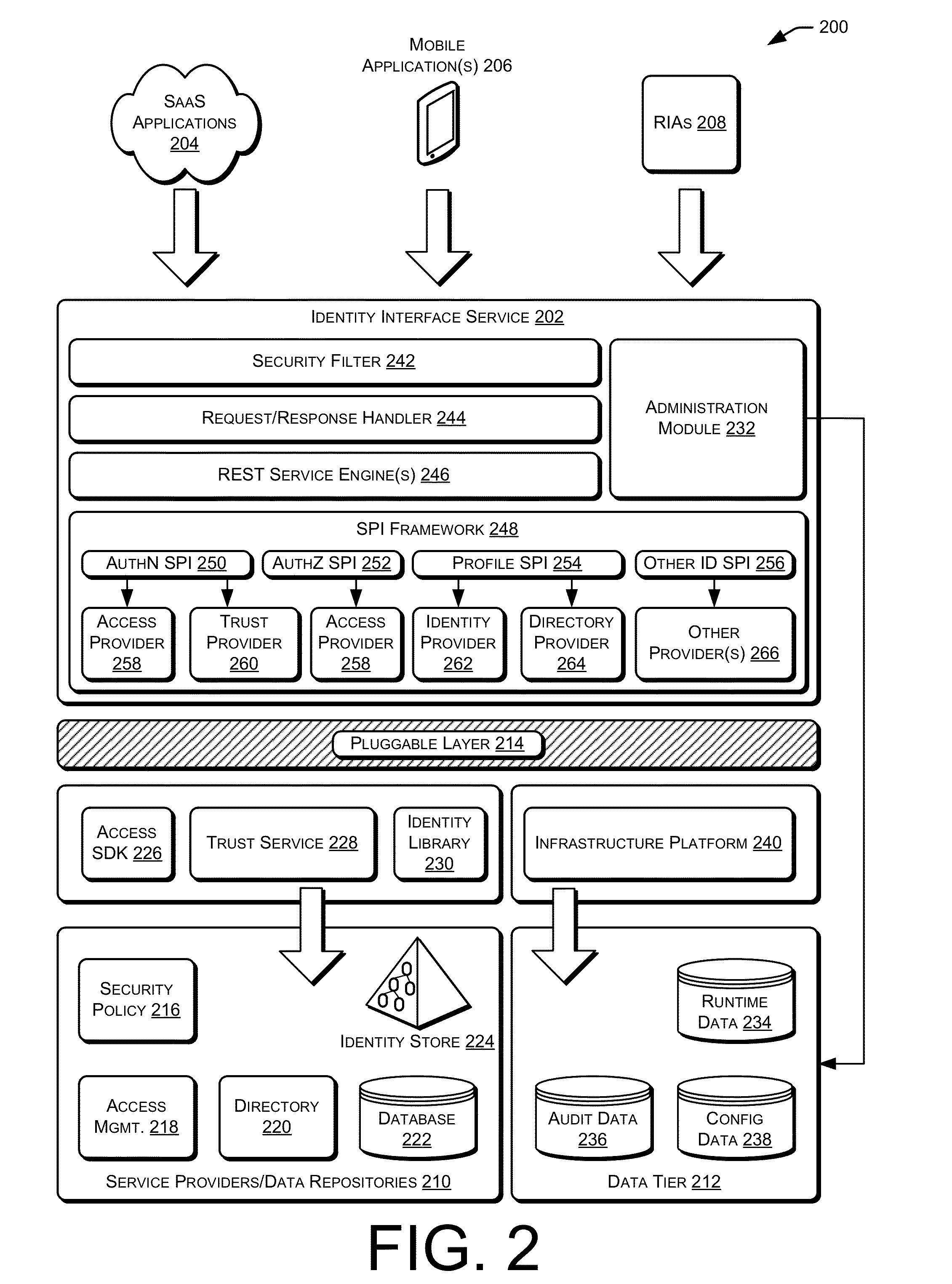

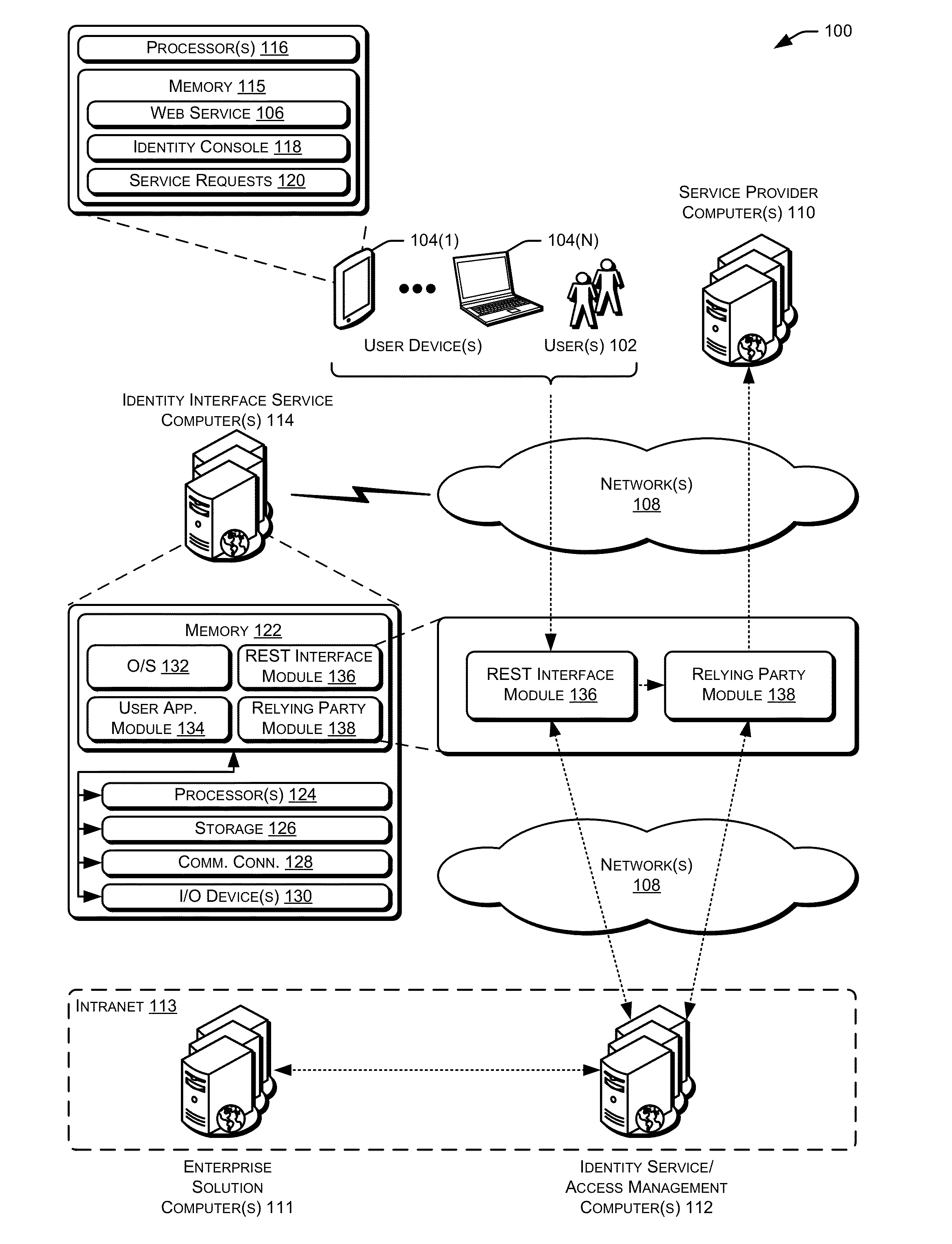

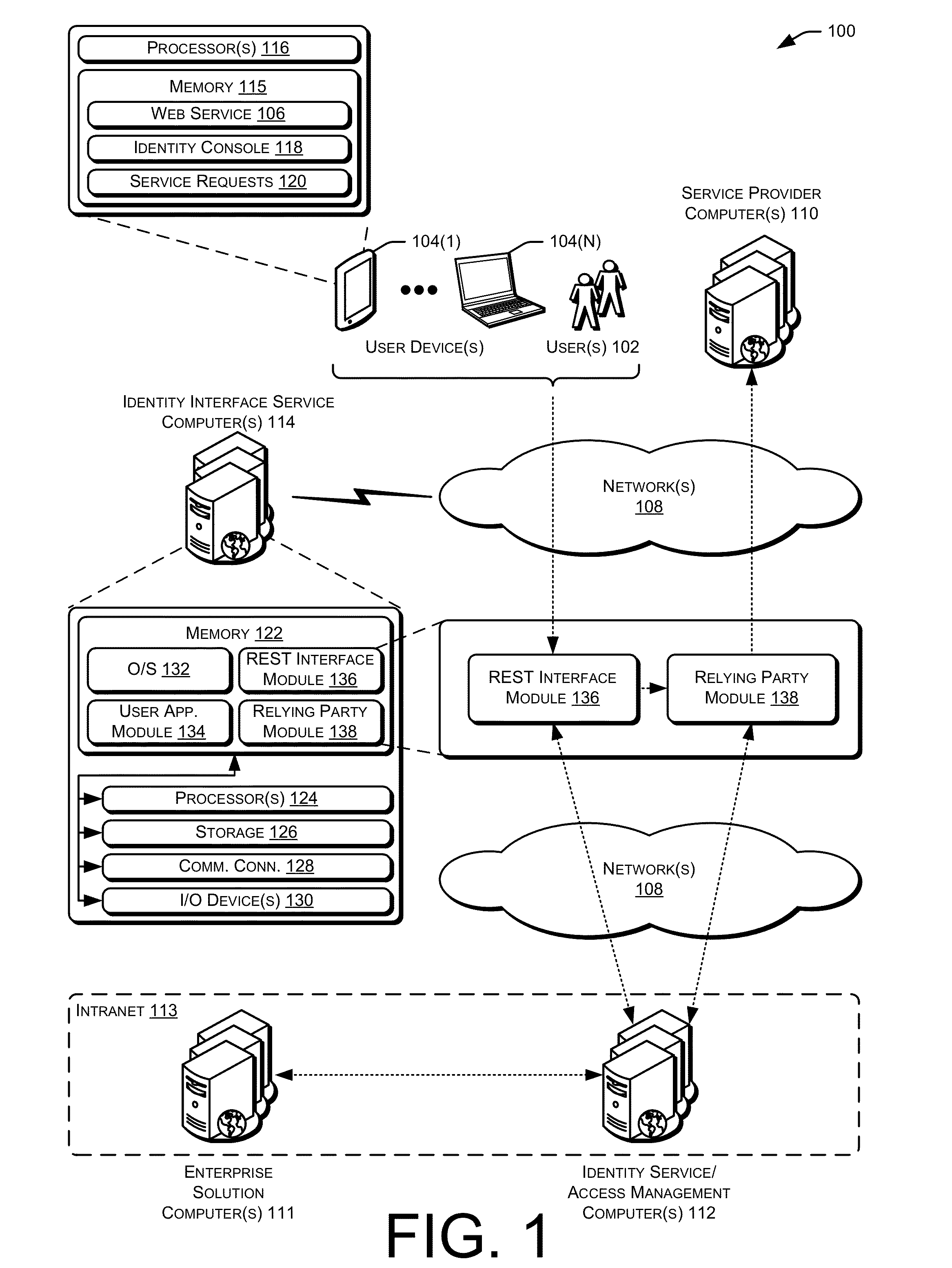

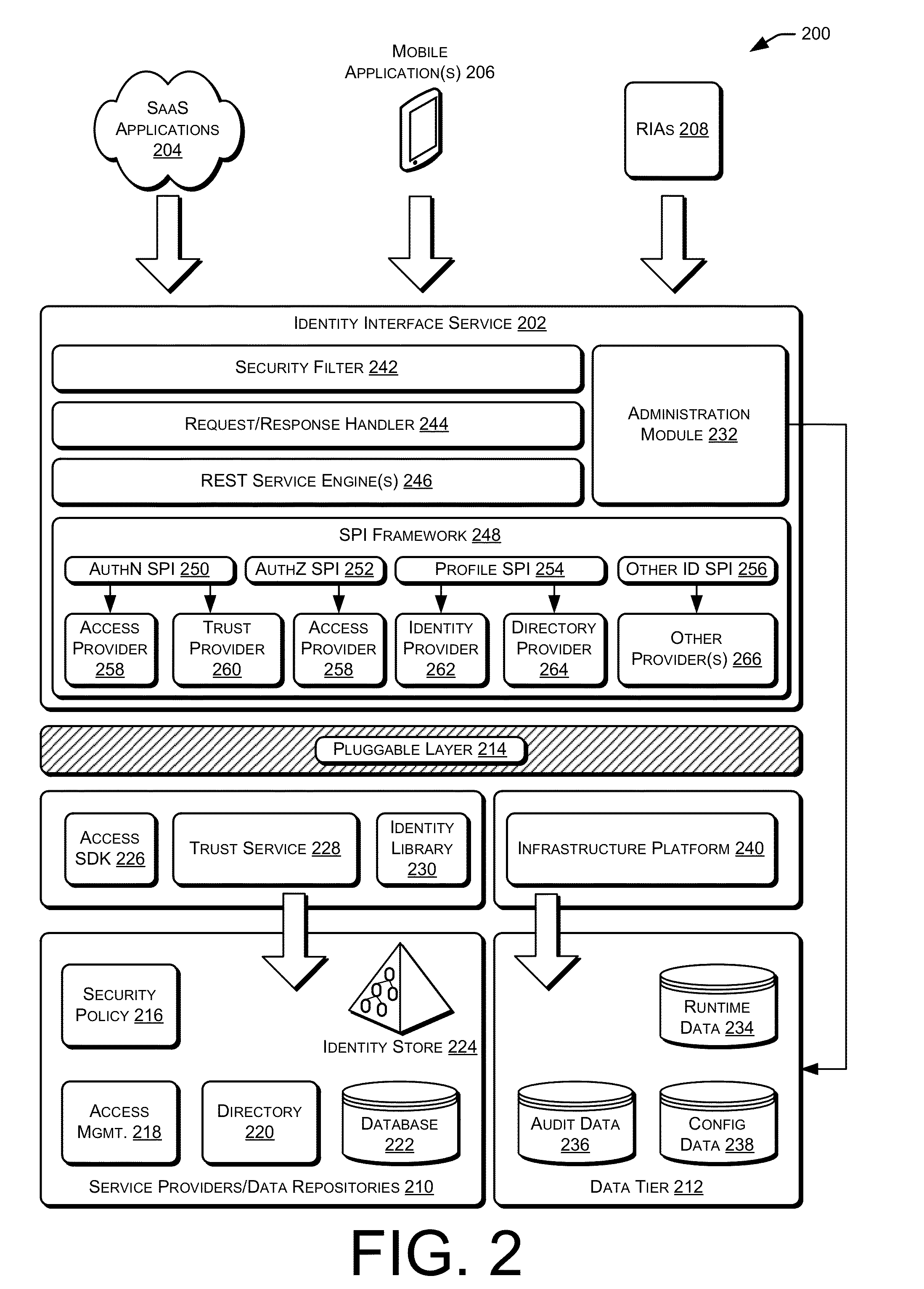

Mobile application, identity interface

ActiveUS20130086639A1Digital data processing detailsMultiple digital computer combinationsApplication programming interfaceApplication software

Techniques for managing identities are provided. In some examples, identity management, authentication, authorization, and token exchange frameworks may be provided for use with mobile devices, mobile applications, cloud applications, and / or other web-based applications. For example a mobile client may request to perform one or more identity management operations associated with an account of a service provider. Based at least in part on the requested operation and / or the particular service provider, an application programming interface (API) may be utilized to generate and / or perform one or more instructions and / or method calls for managing identity information of the service provider.

Owner:ORACLE INT CORP

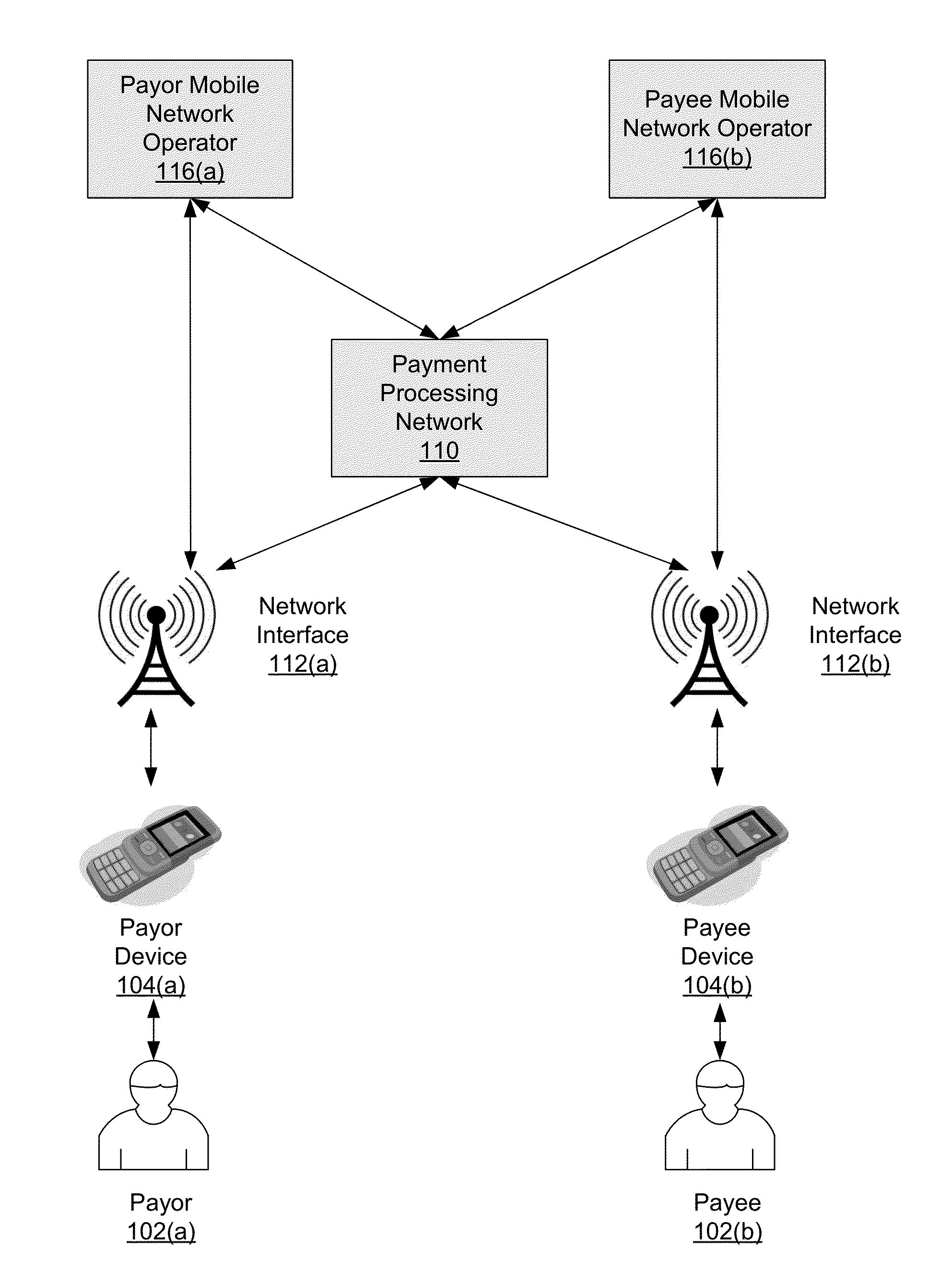

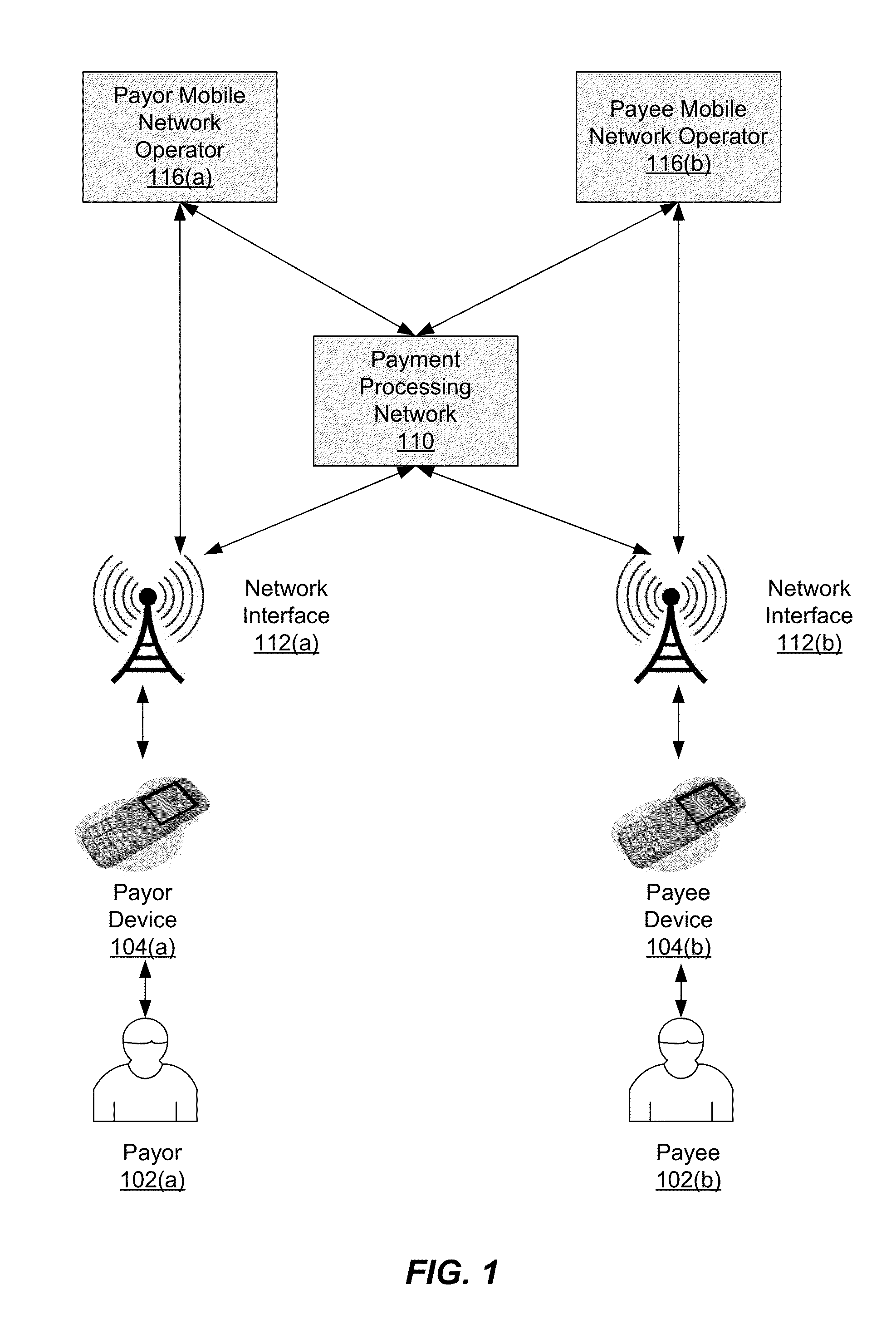

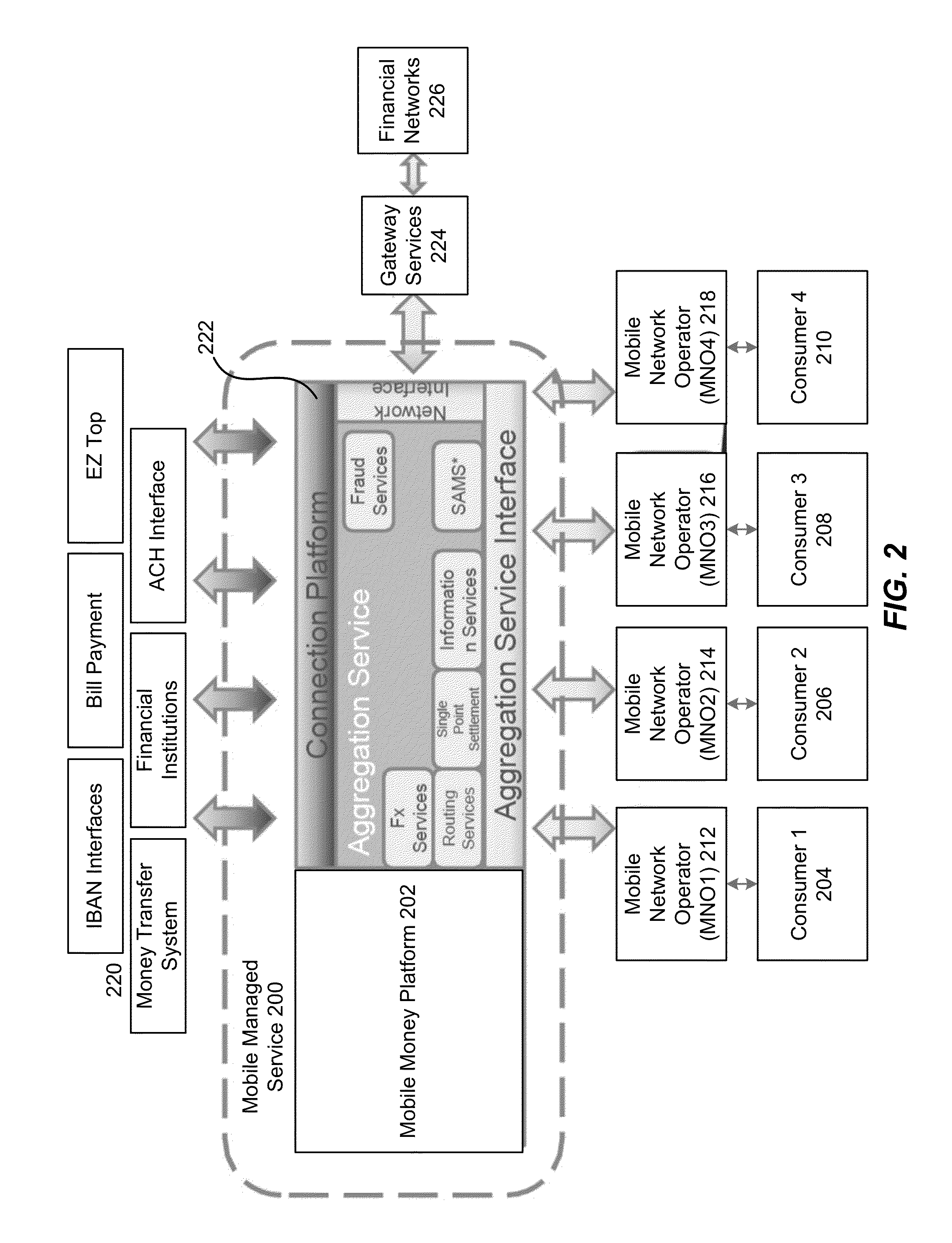

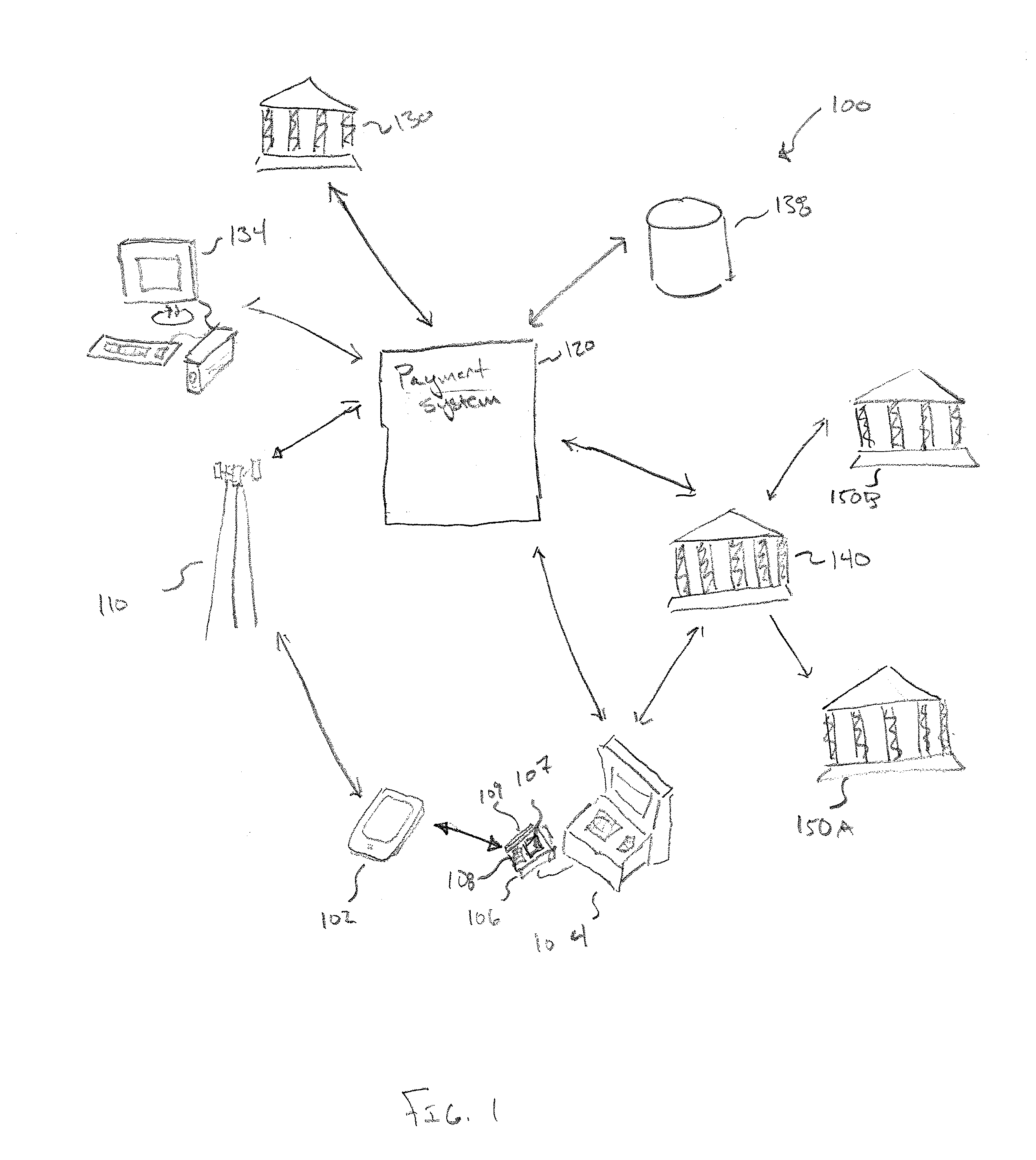

Mobile Funding Method and System

Systems and methods for mobile funding are provided. One such method comprises receiving a transaction request to transfer funds from a payor to a payee. The transaction request can include a payor device identifier, a payee device identifier and an amount. A payor account identifier associated with the payor device identifier, and a payee account identifier associated with the payee device identifier can each be determined. Additionally, a first service provider associated with the payor device can be determined based on the payor device identifier, and a second service provider associated with the payee device can be determined based on the payee device identifier. The transfer of funds from the first service provider to the second service provider can then be initiated using the payor account identifier and the payee account identifier. At least one of the first and second service providers is a mobile network operator.

Owner:VISA INT SERVICE ASSOC

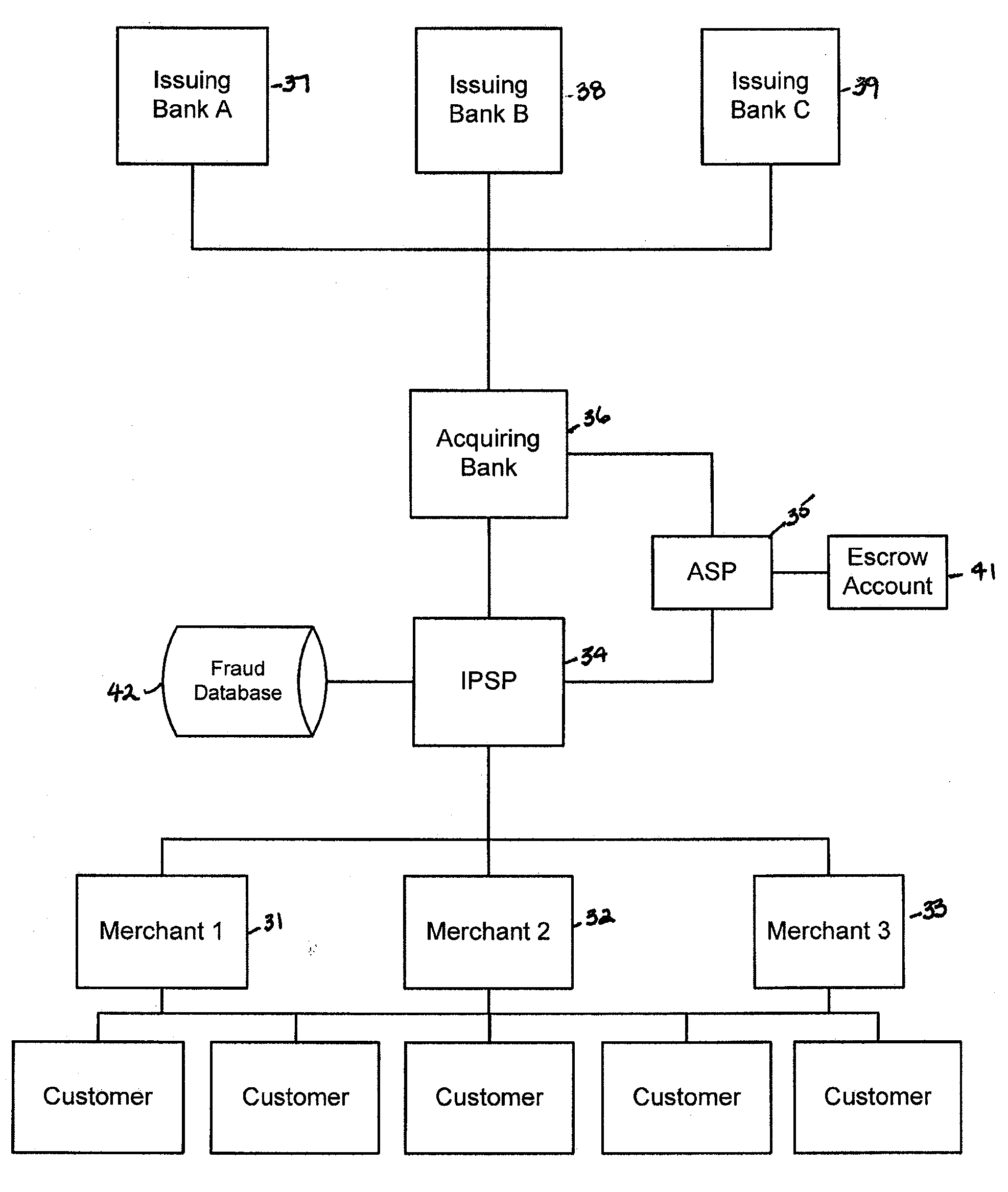

Financial transactions systems and methods

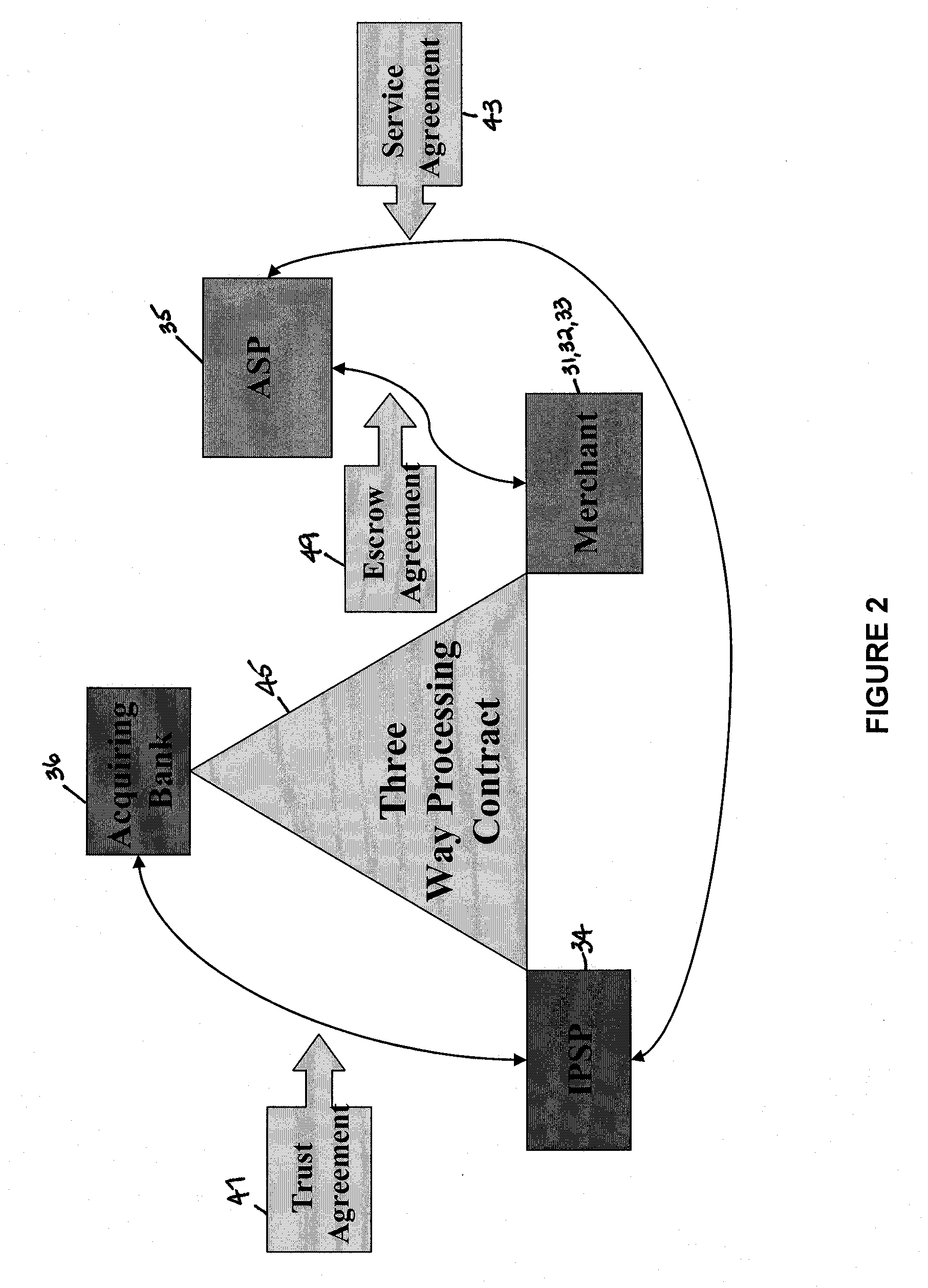

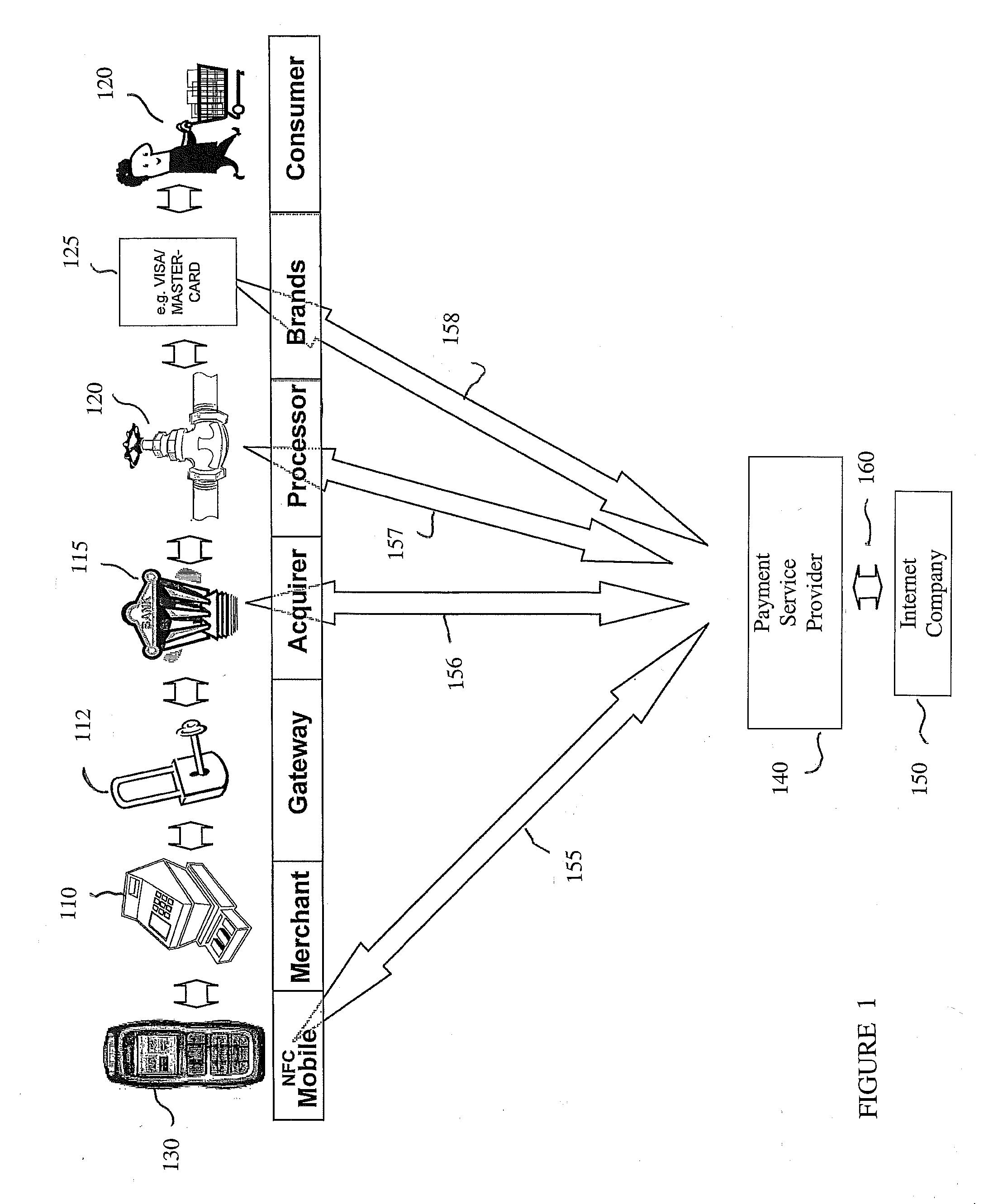

InactiveUS20100106611A1Reduce percentageFinanceApparatus for meter-controlled dispensingPayment transactionService provision

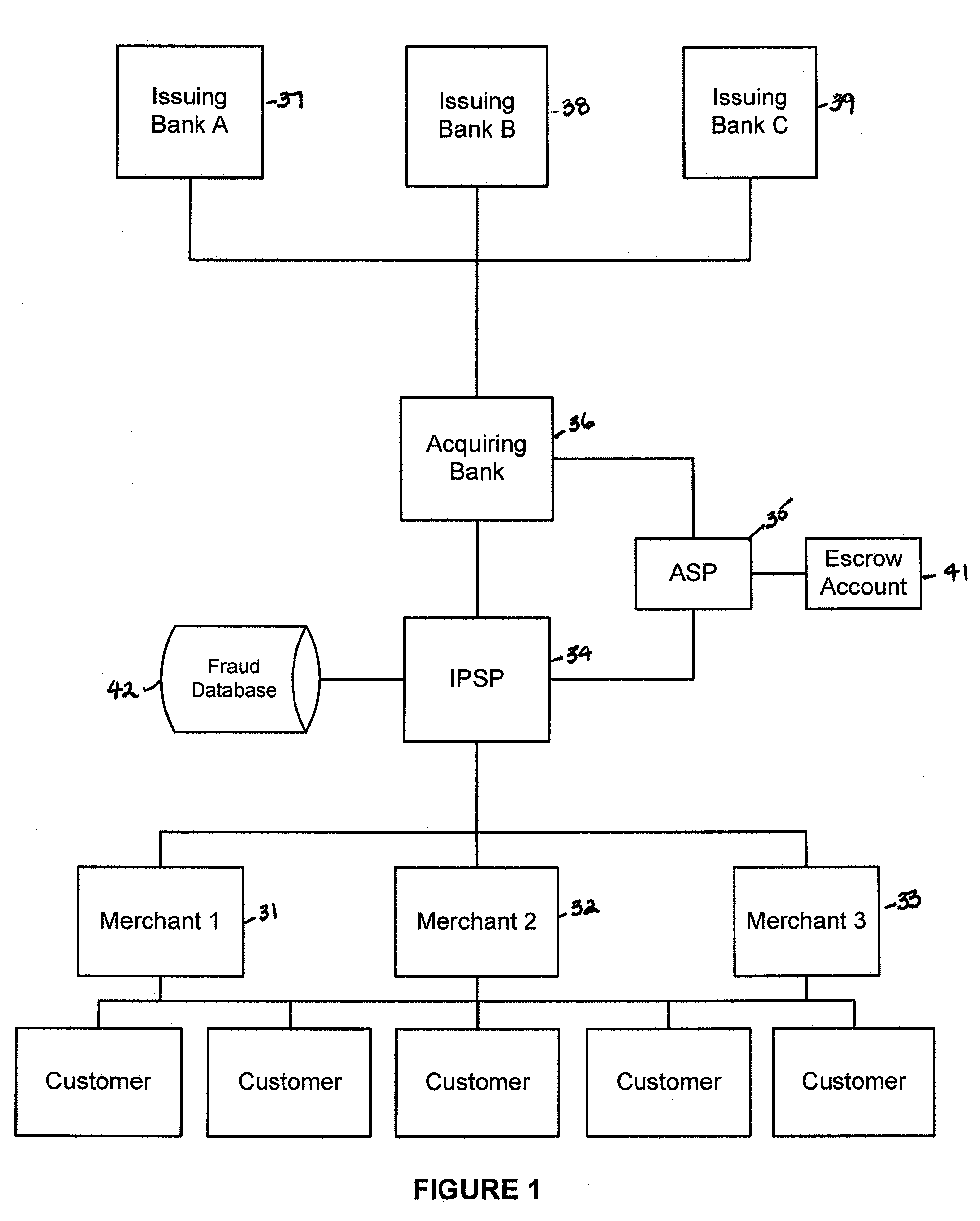

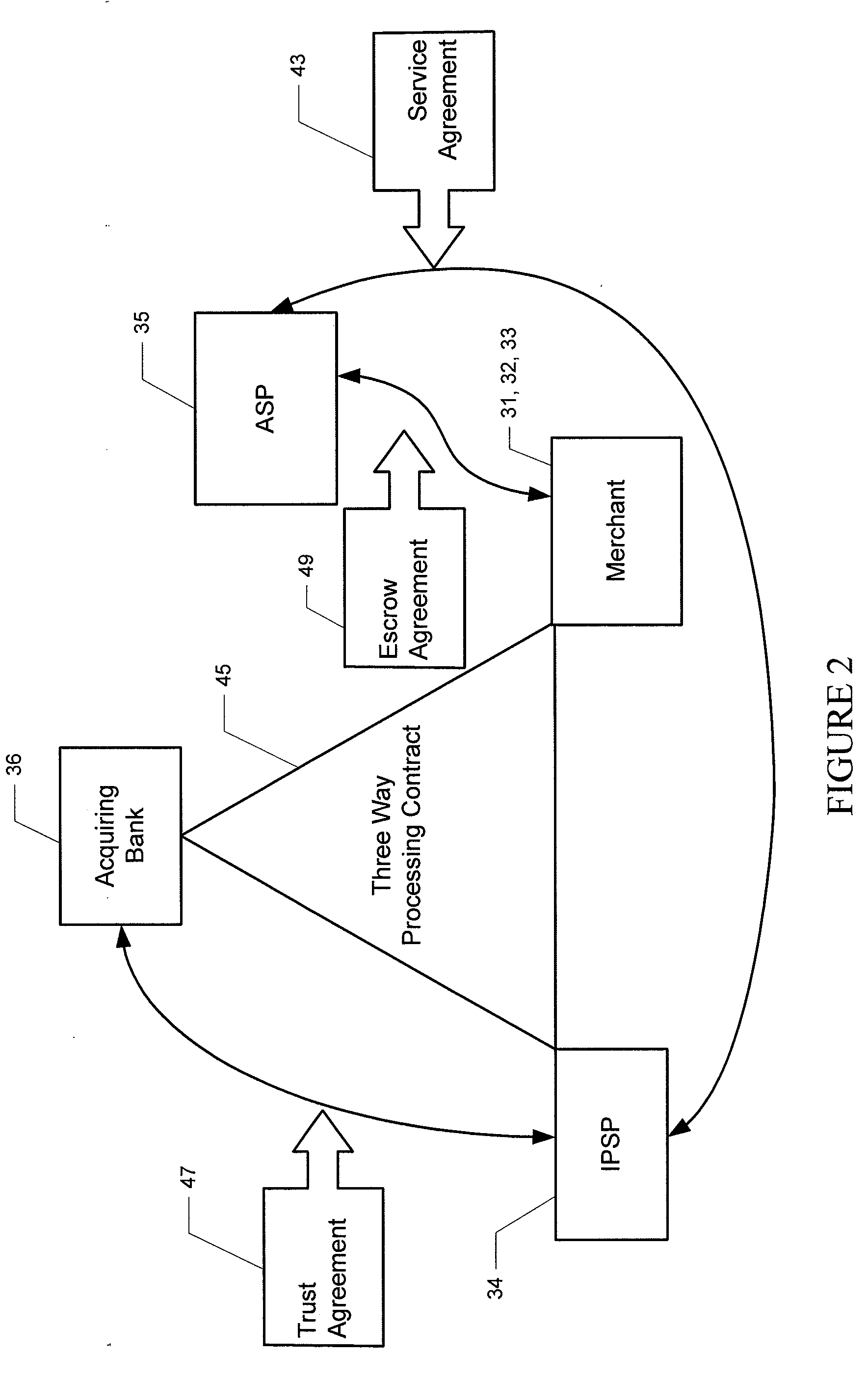

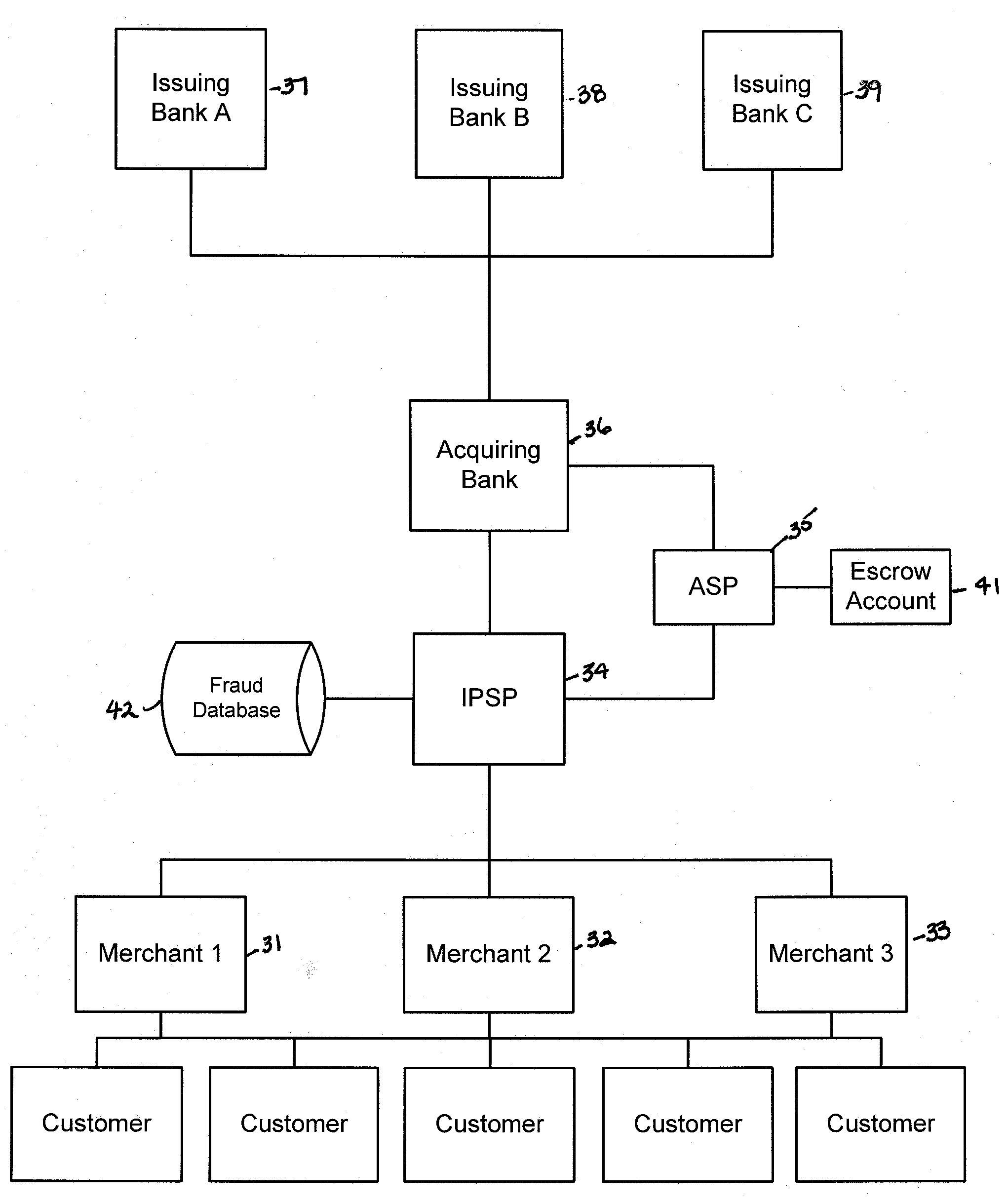

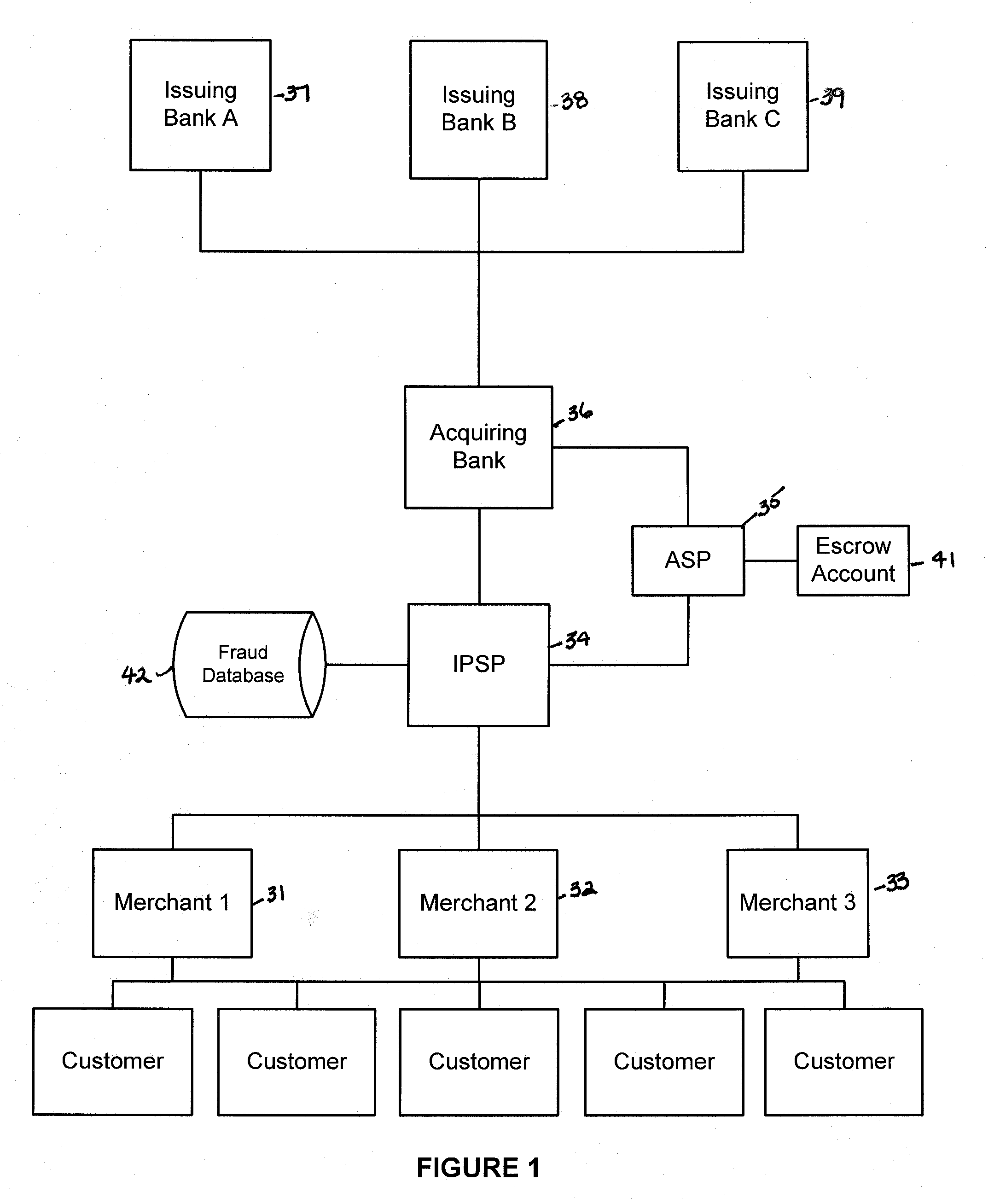

Various embodiments of the invention provide a more secure financial transaction system for e-commerce sectors that (1) more securely processes payment transactions, (2) helps to protect merchants and banks against fraudulent transactions, money laundering, and underage gambling, and (3) helps to limit other abuses in areas of e-commerce that are perceived to pose special risks, such as Internet gaming, travel, and consumer purchasing of electronic goods. To accomplish the above goals, various embodiments of the financial transaction system (1) establish operating and transaction processing protocols for merchants, Internet payment service providers, acquiring banks, and card schemes and (2) provide automated systems for monitoring and securely processing payment and financial transactions.

Owner:TRUST PAYMENTS LTD

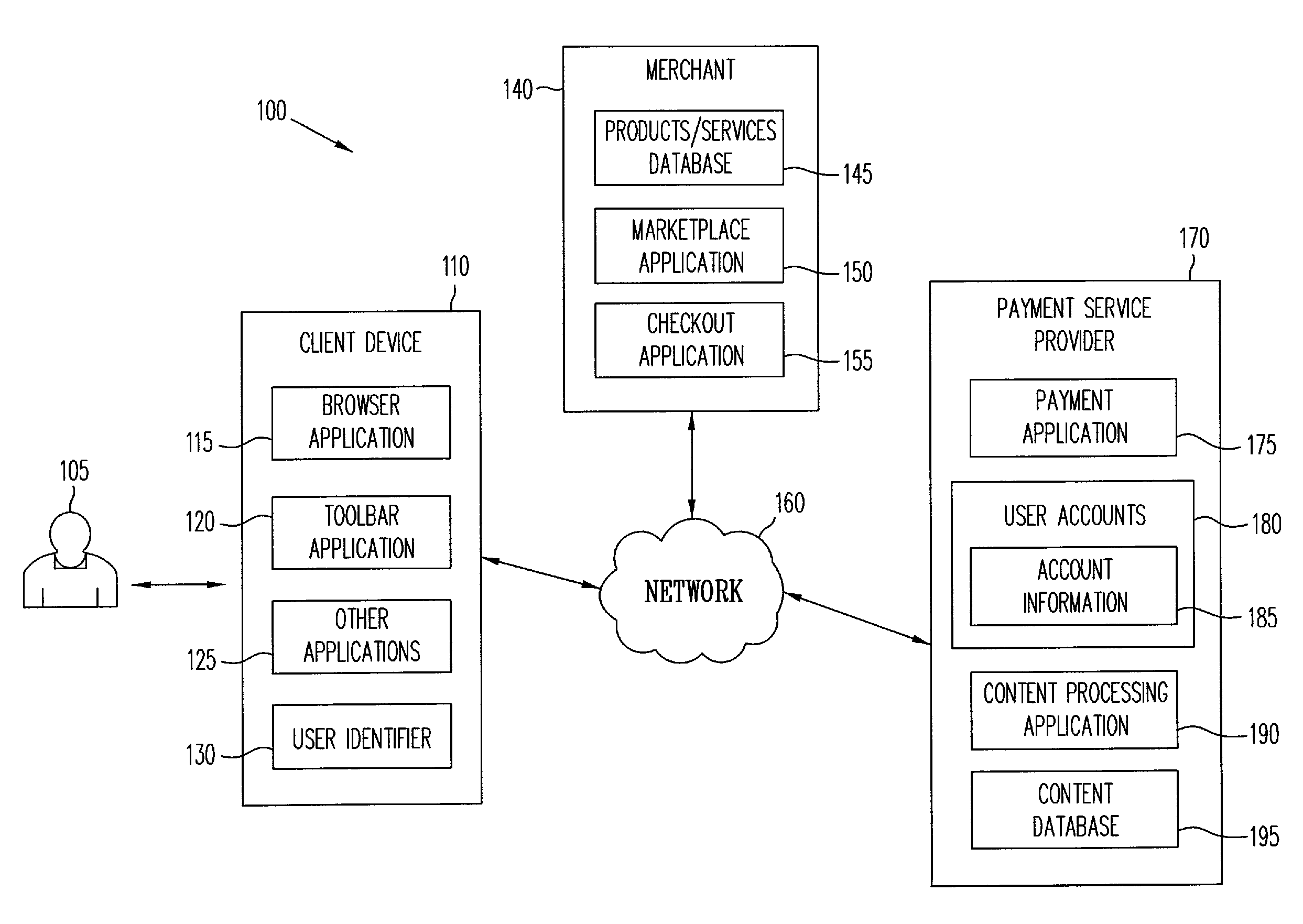

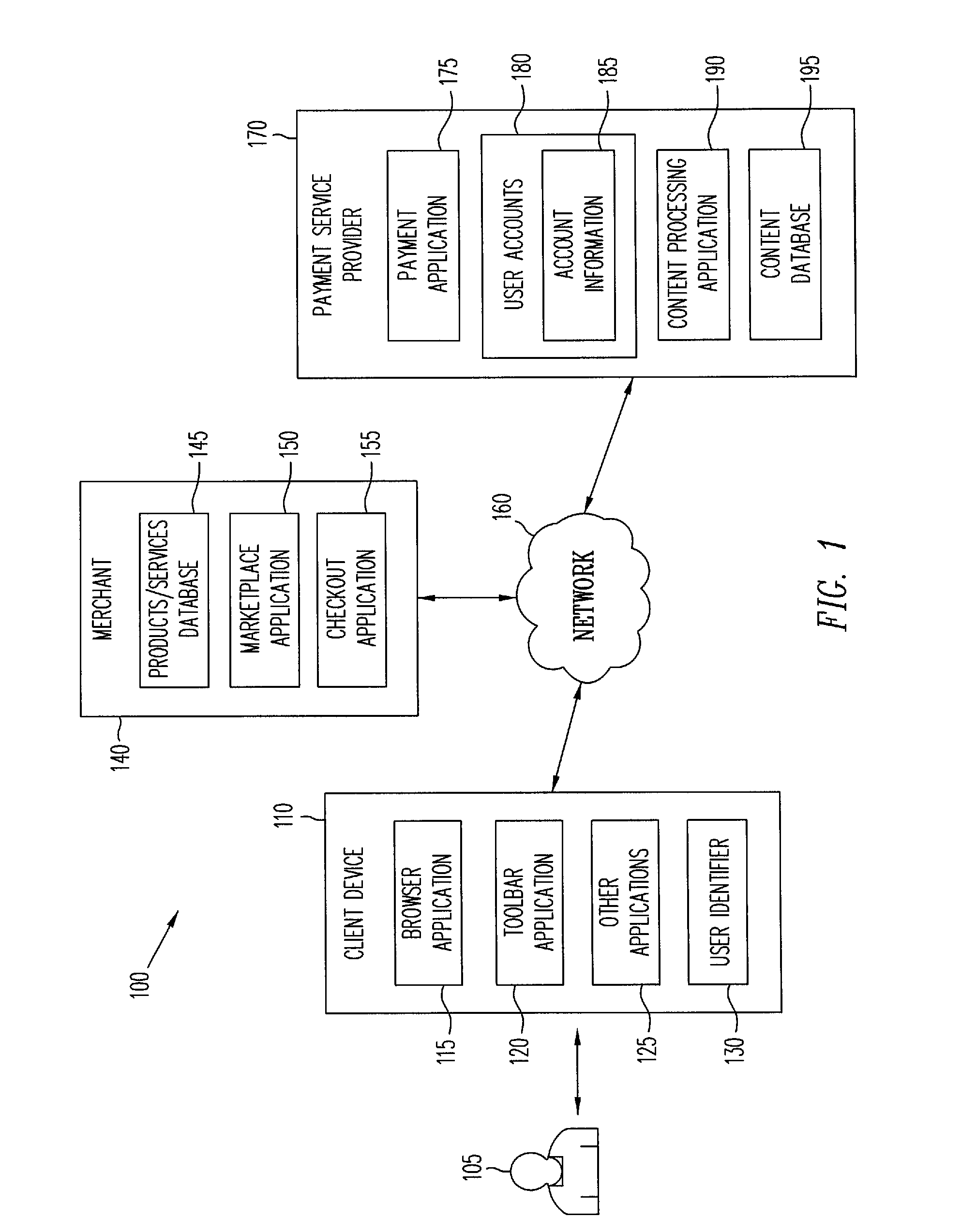

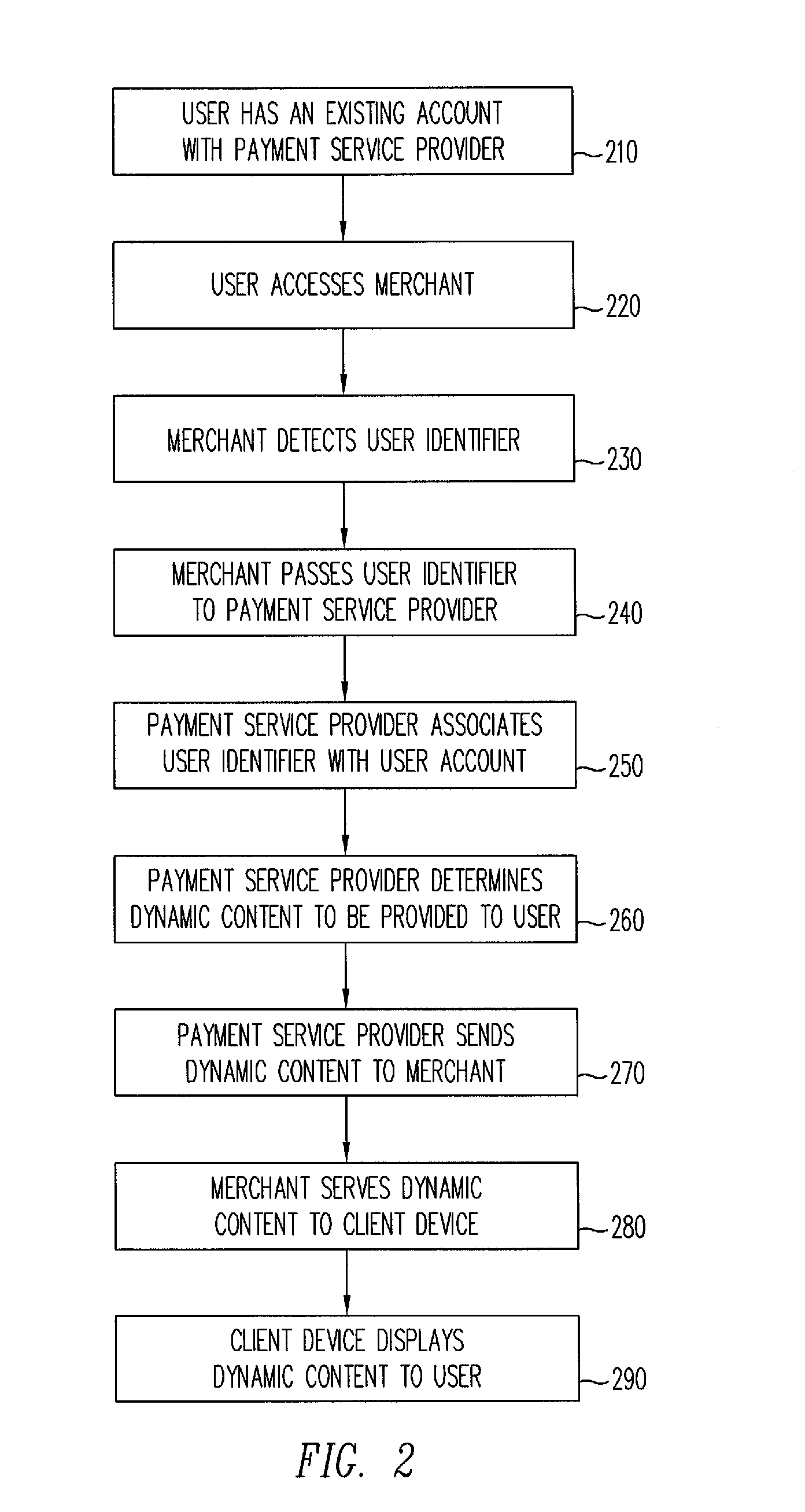

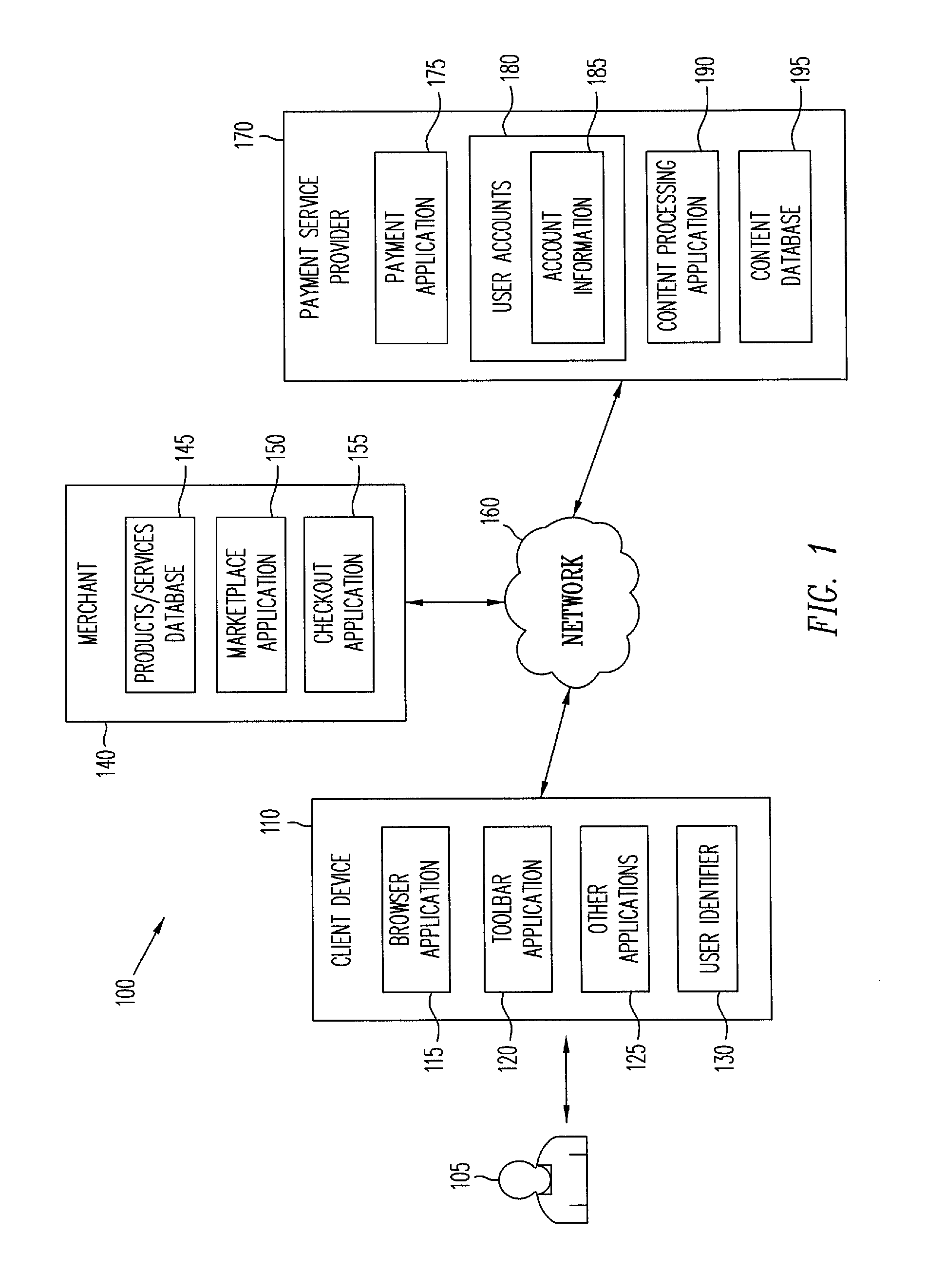

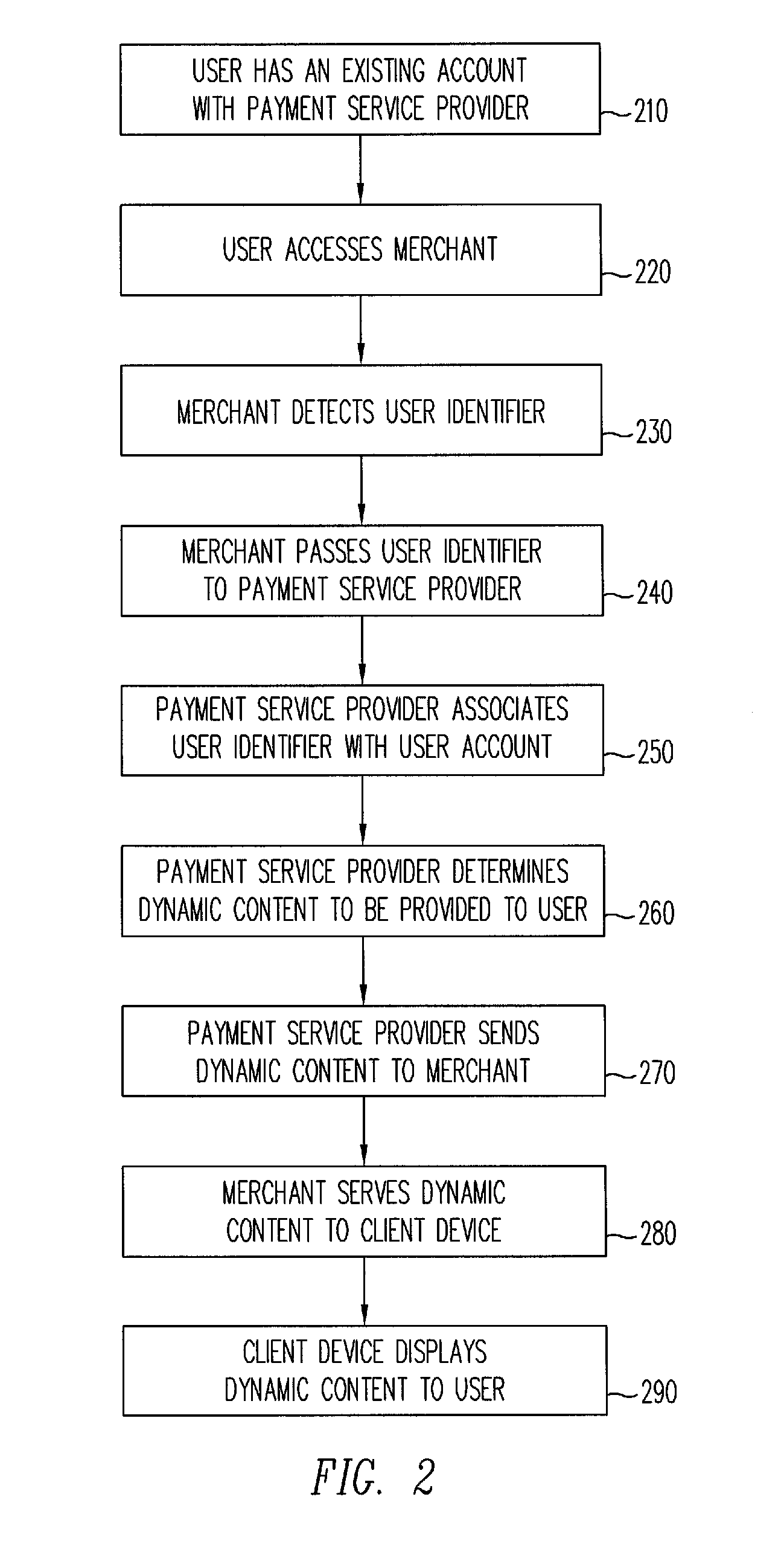

Dynamic content for online transactions

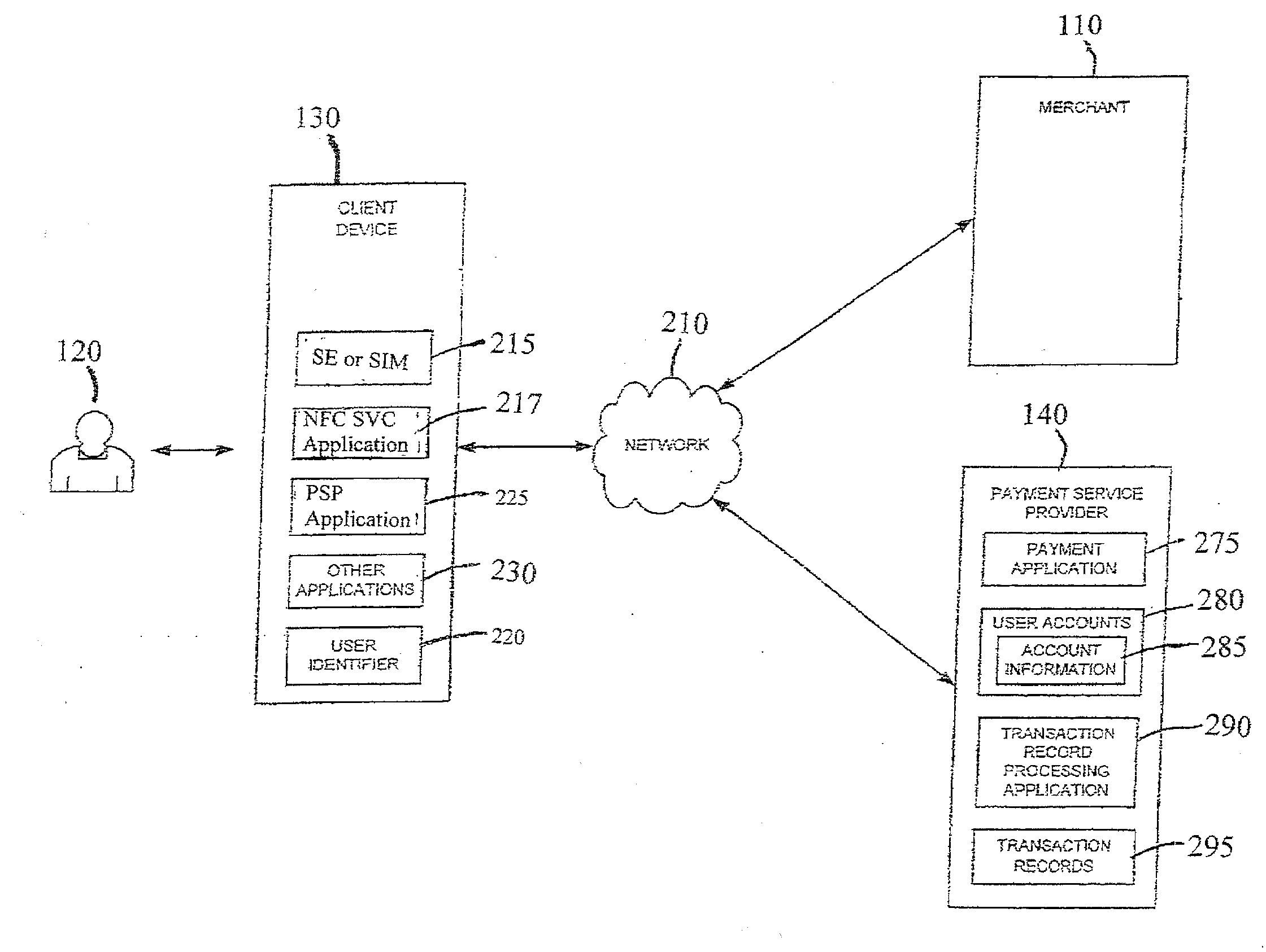

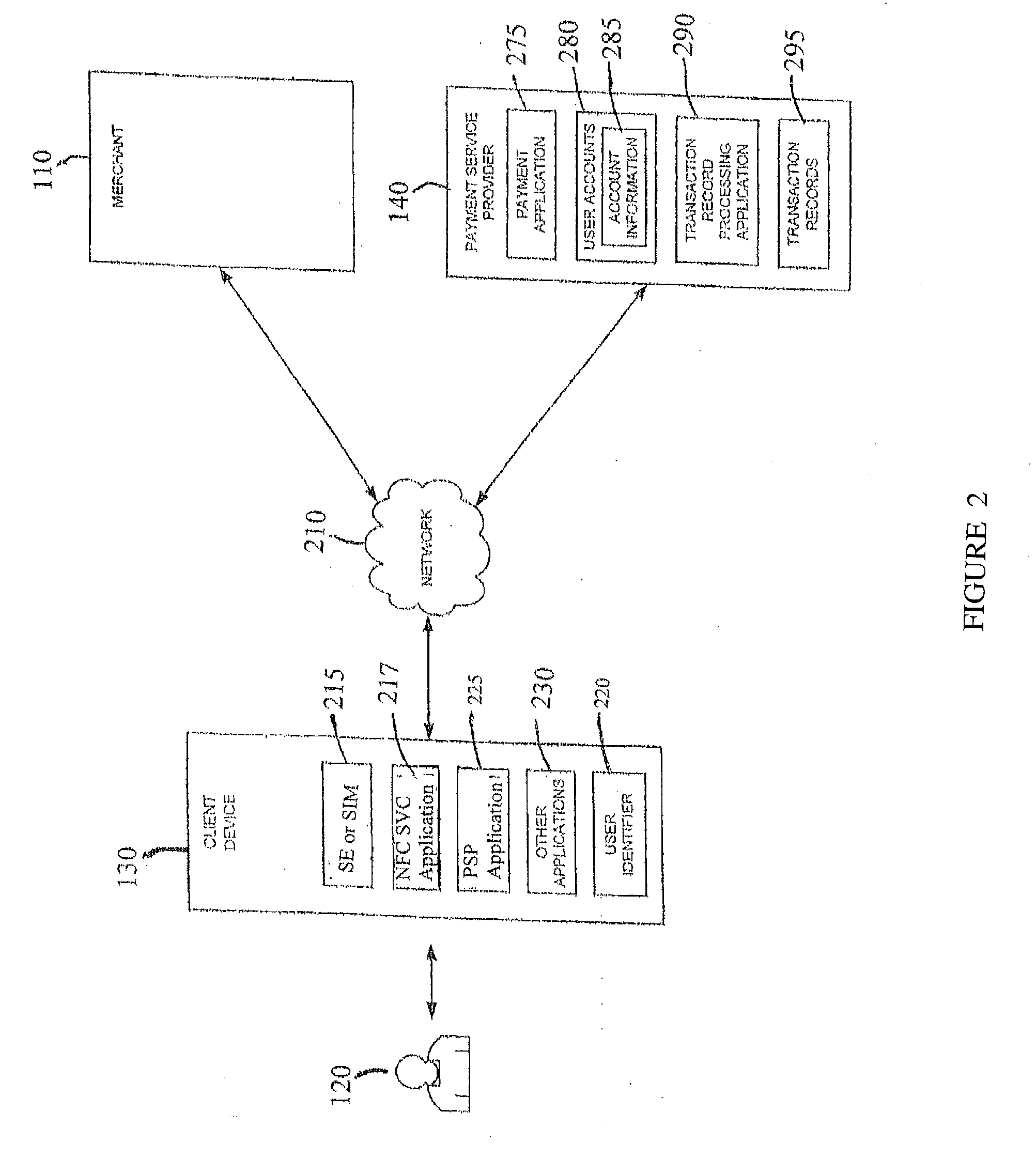

ActiveUS8028041B2Promote disseminationFinanceMultiple digital computer combinationsClient-sideUser identifier

Various methods and systems provide dynamic content to users of online payment service providers without requiring users to log in or otherwise actively engage the payment service providers. In one example, a method includes providing a client device with access to an online marketplace over a network. The method also includes facilitating transmission of a user identifier stored by the client device to a payment service provider. The method further includes receiving dynamic content from the payment service provider in response to the user identifier. In addition, the method includes serving the dynamic content to the client device over the network.

Owner:PAYPAL INC

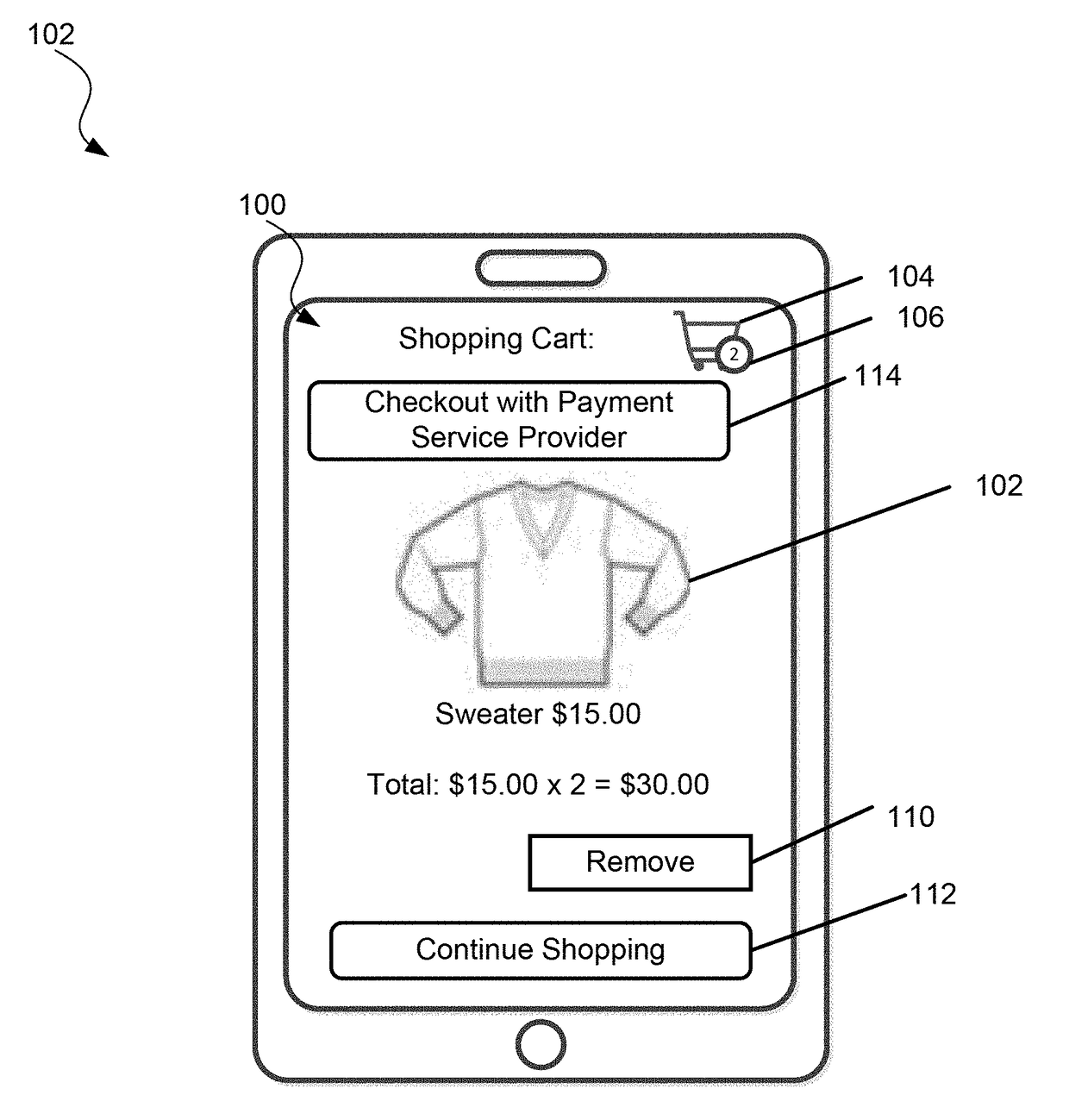

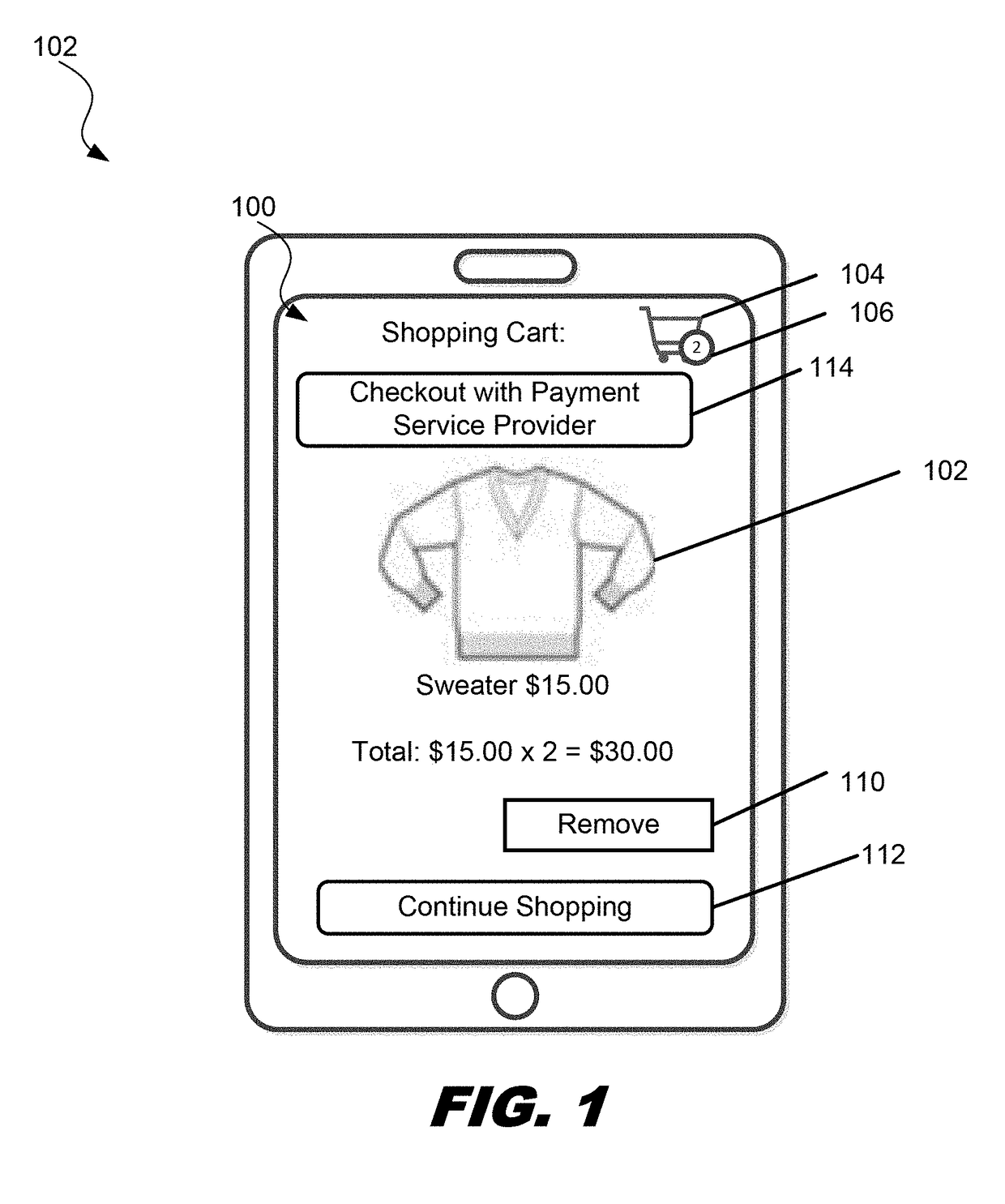

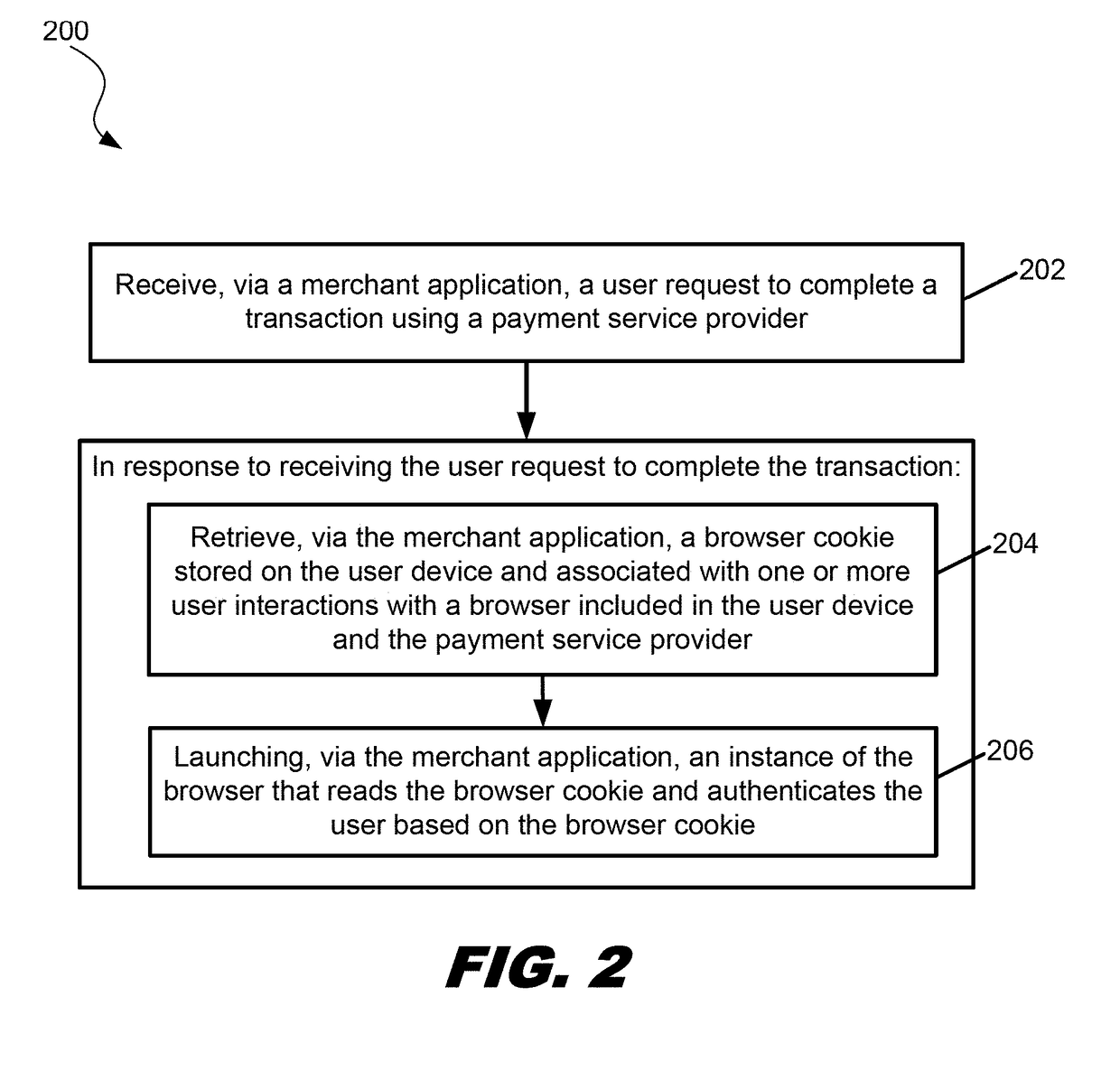

User authentication using a browser cookie shared between a browser and an application

A system and / or method may be provided to authenticate a user. An example method of authenticating a user includes receiving, by a merchant application, a user request to complete a transaction using a payment service provider. The method also includes in response to receiving the user request to complete the transaction, retrieving, by the merchant application, a browser cookie stored on a user device and associated with one or more user interactions with a browser included in the user device and the payment service provider. The method further includes in response to receiving the user request to complete the transaction, launching, by the merchant application, an instance of the browser that reads the browser cookie and authenticates the user based on the browser cookie.

Owner:PAYPAL INC

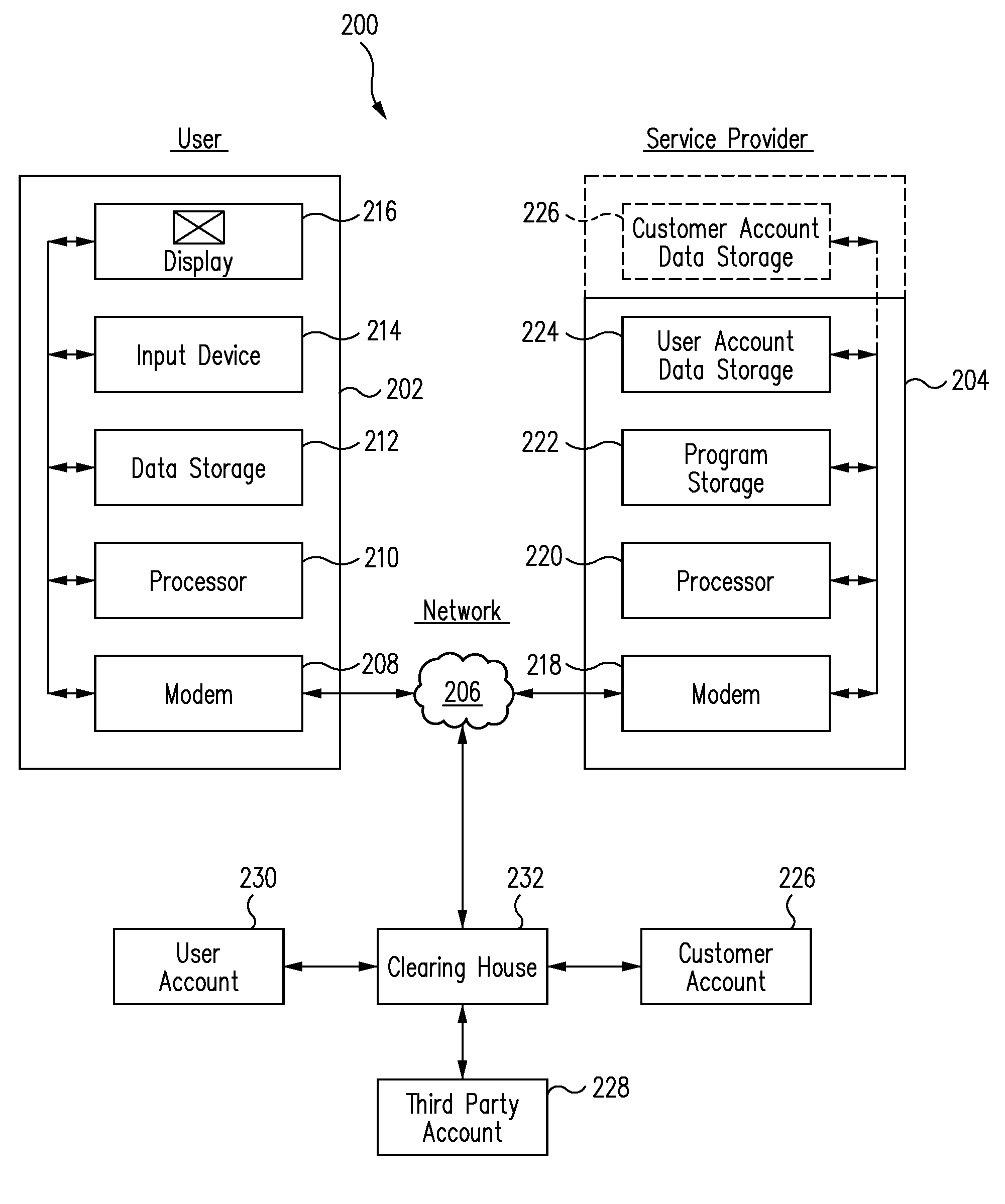

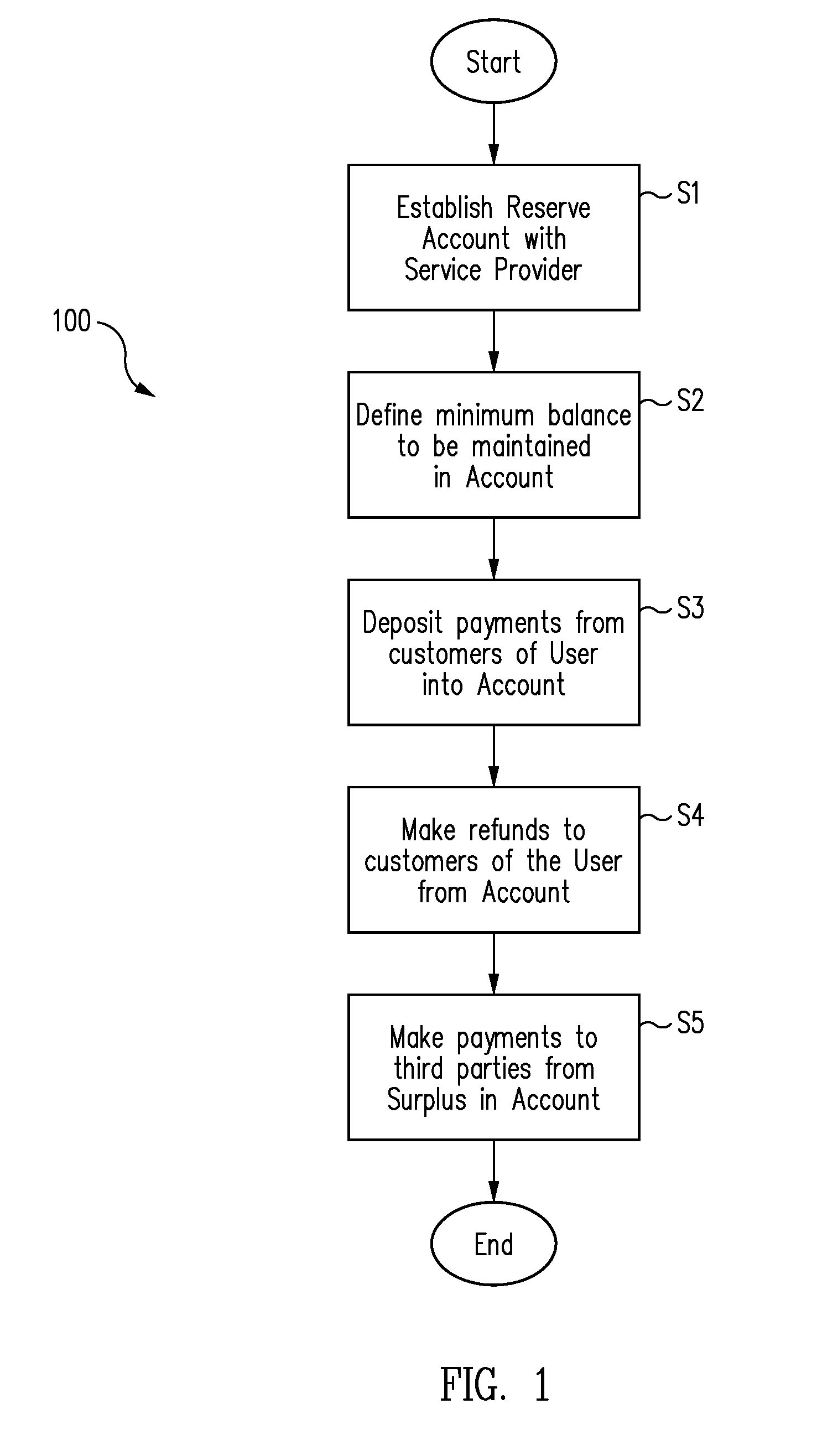

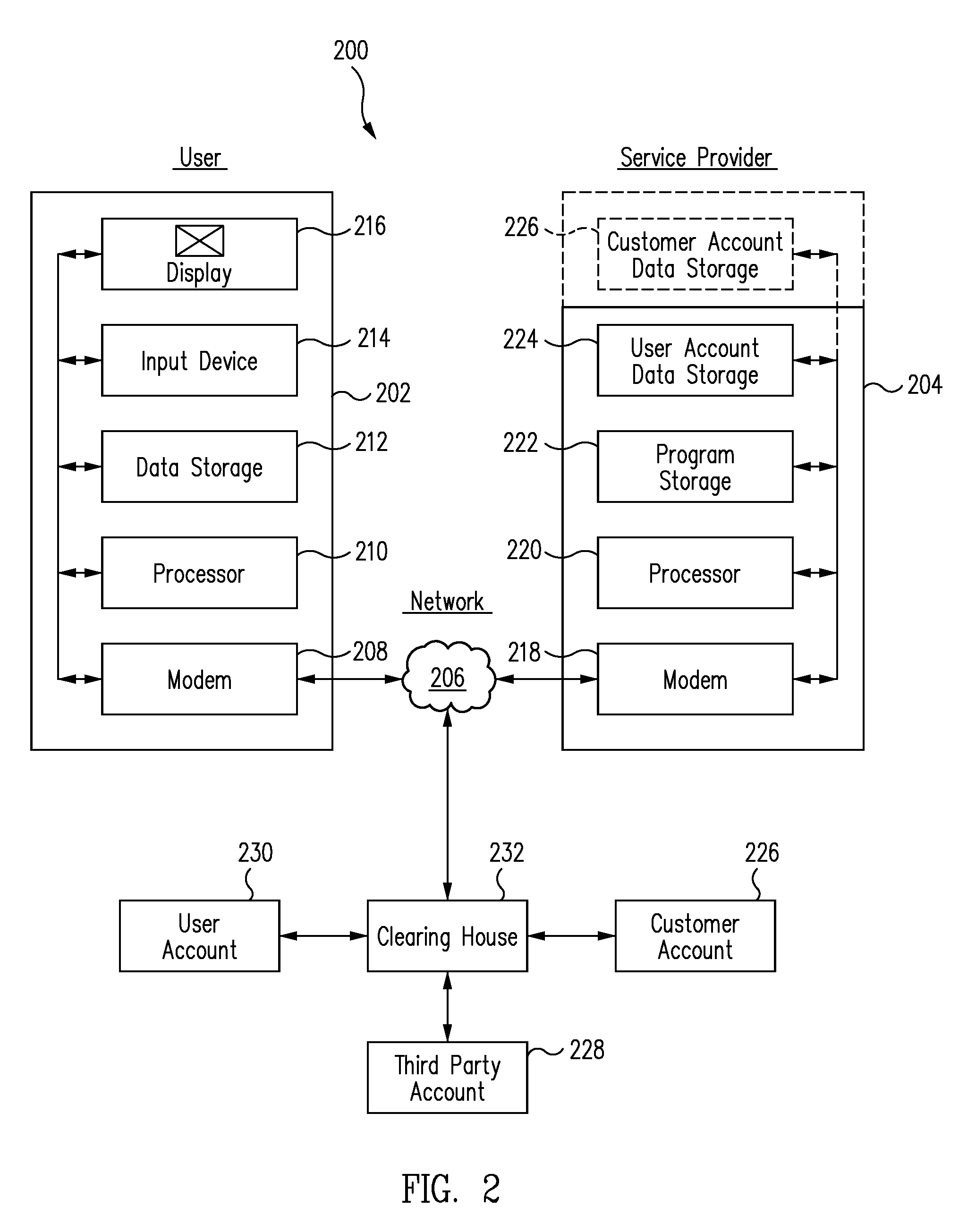

Customer refunds using payment service providers

A method by which a merchant can establish and advantageously use an account at an online payment service provider for making both payments and refunds to customers so as to minimize overdraft or non-sufficient funds (NSF) occurrences and the attendant delays and loss of customer good will includes providing at least one processor communicating through at least one network, and using the at least one processor and network to receive a refund request, access a user reserve account with an online payment service provider, wherein the reserve account is associated with a regular account of the user with the payment service provider, and processing the refund request from the reserve account.

Owner:PAYPAL INC

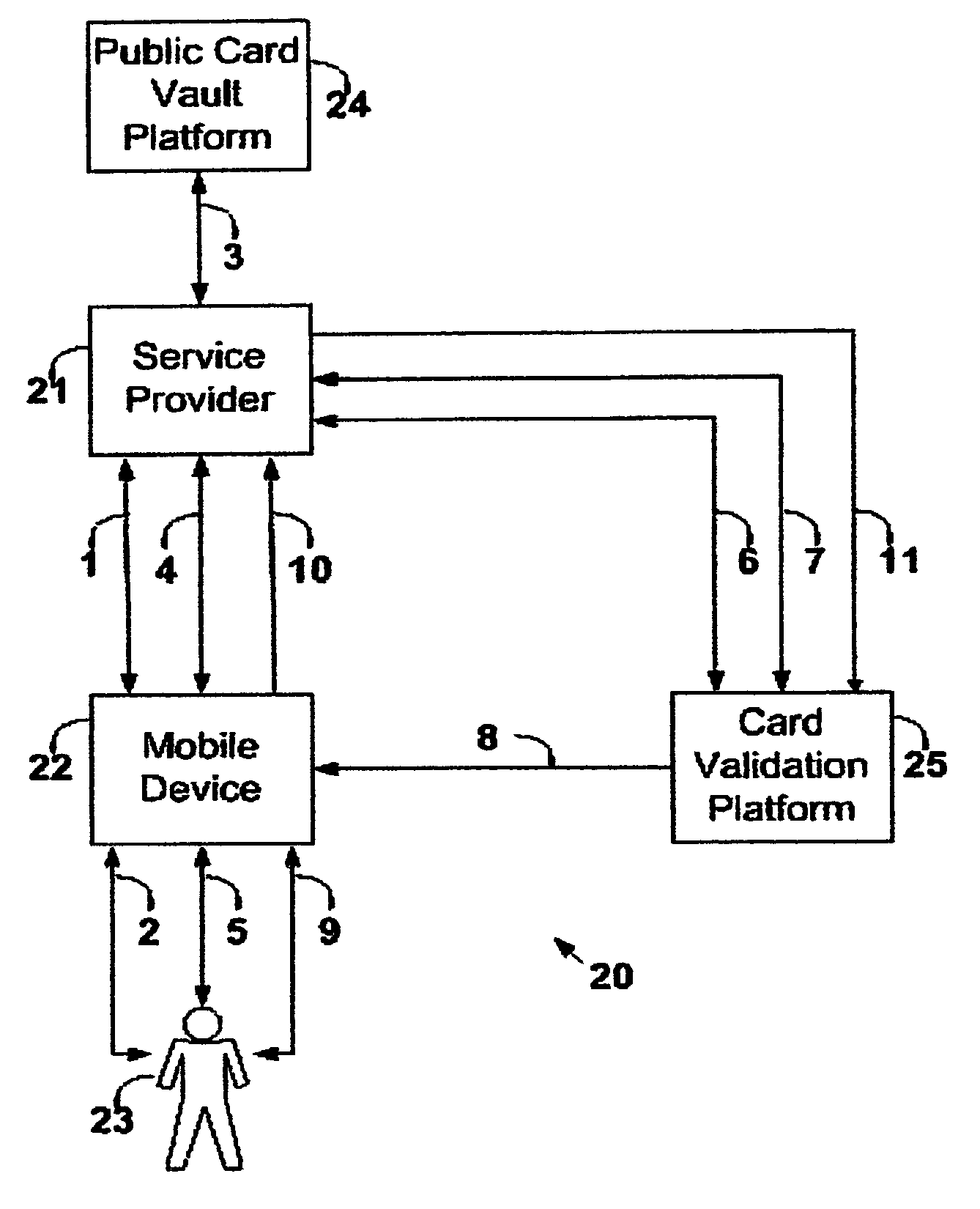

Wireless payment processing system

InactiveUS6988657B1Improve the security environmentImprove securityFinanceElectronic credentialsPrivate networkBluetooth

The transaction method is for secure payment by credit cards or debit cards for goods or services with the use or mobile devices. The payment authorization center delivers a public portion of the authorization token to the service provider via the existing communication channels and the private portion of the authorization token is delivered to the mobile device via SMS or USSD or e-mail short message. The mobile device delivers the private authorization token to the service provider via a private local network based on bluetooth, infrared or other short radio frequency based technology. The credit card or debit card number is never revealed and a temporary card token replaces it.

Owner:ROK MONICA LINDA

Systems and methods for determining regulations governing financial transactions conducted over a network

Various embodiments of the invention provide a more secure financial transaction system for e-commerce sectors that (1) more securely processes payment transactions, (2) helps to protect merchants and banks against fraudulent transactions, money laundering, and underage gambling, and (3) helps to limit other abuses in areas of e-commerce that are perceived to pose special risks, such as Internet gaming, travel, and consumer purchasing of electronic goods. To accomplish the above goals, various embodiments of the financial transaction system (1) establish operating and transaction processing protocols for merchants, Internet payment service providers, acquiring banks, and card schemes and (2) provide automated systems for monitoring and securely processing payment and financial transactions.

Owner:TILLY BAKER +1

Mobile User Identify And Risk/Fraud Model Service

InactiveUS20090307778A1Risk dataGeneration of riskDigital data processing detailsAnalogue secracy/subscription systemsIdentity theftBluetooth

Transactions using, for example, Near Field Communication (NFC), Bluetooth, online, or other applications, may pose a risk of fraud or identity theft. According to an embodiment, a method of evaluating transaction information in view of potential fraud and / or risk includes receiving transaction information at a remote location. The method also includes correlating the received transaction information with user data maintained at the remote location. The method further includes generating a score and / or risk or fraud data based on the correlating. Such transactions may be facilitated by a payment service provider. Related methods, devices, and systems are also disclosed.

Owner:PAYPAL INC

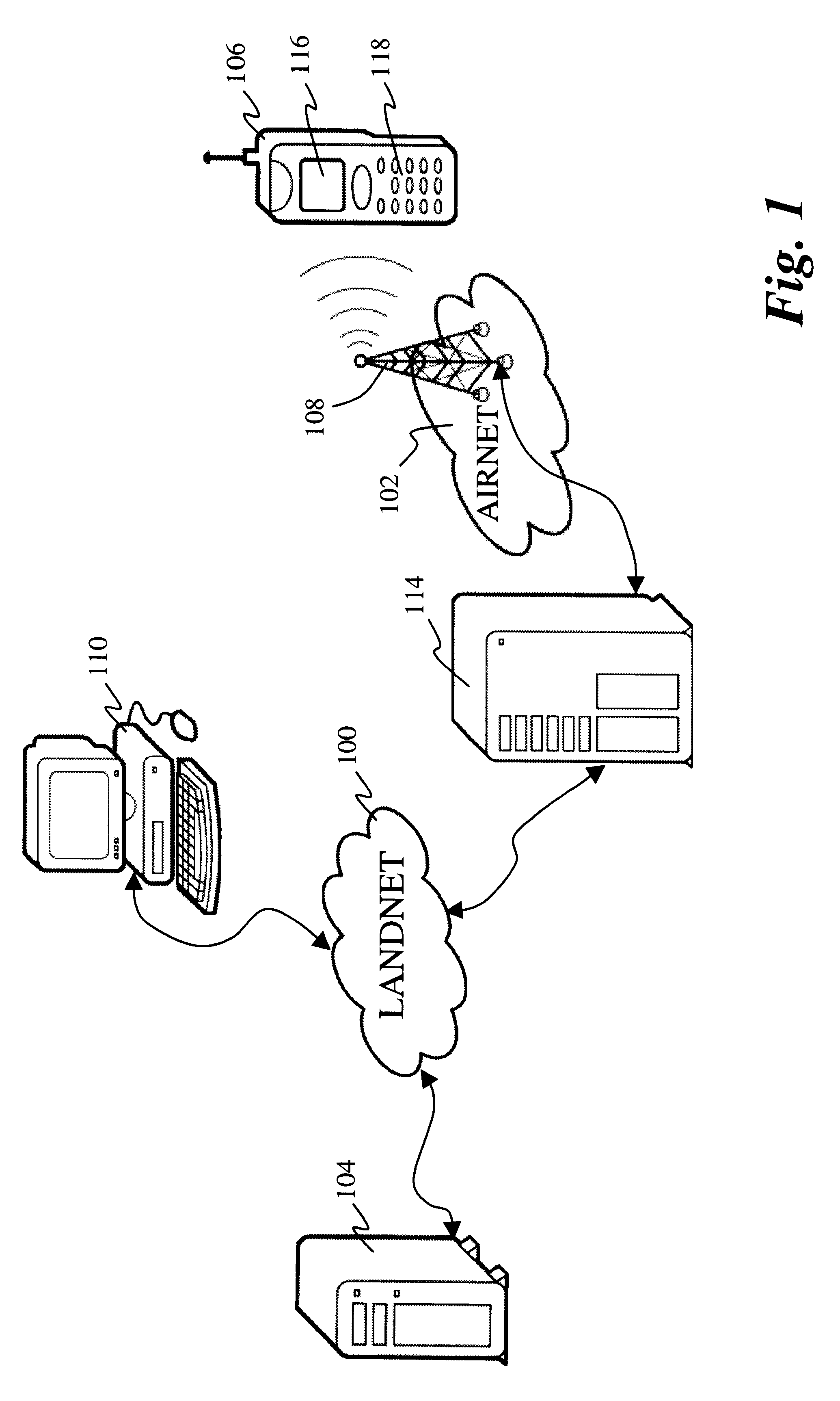

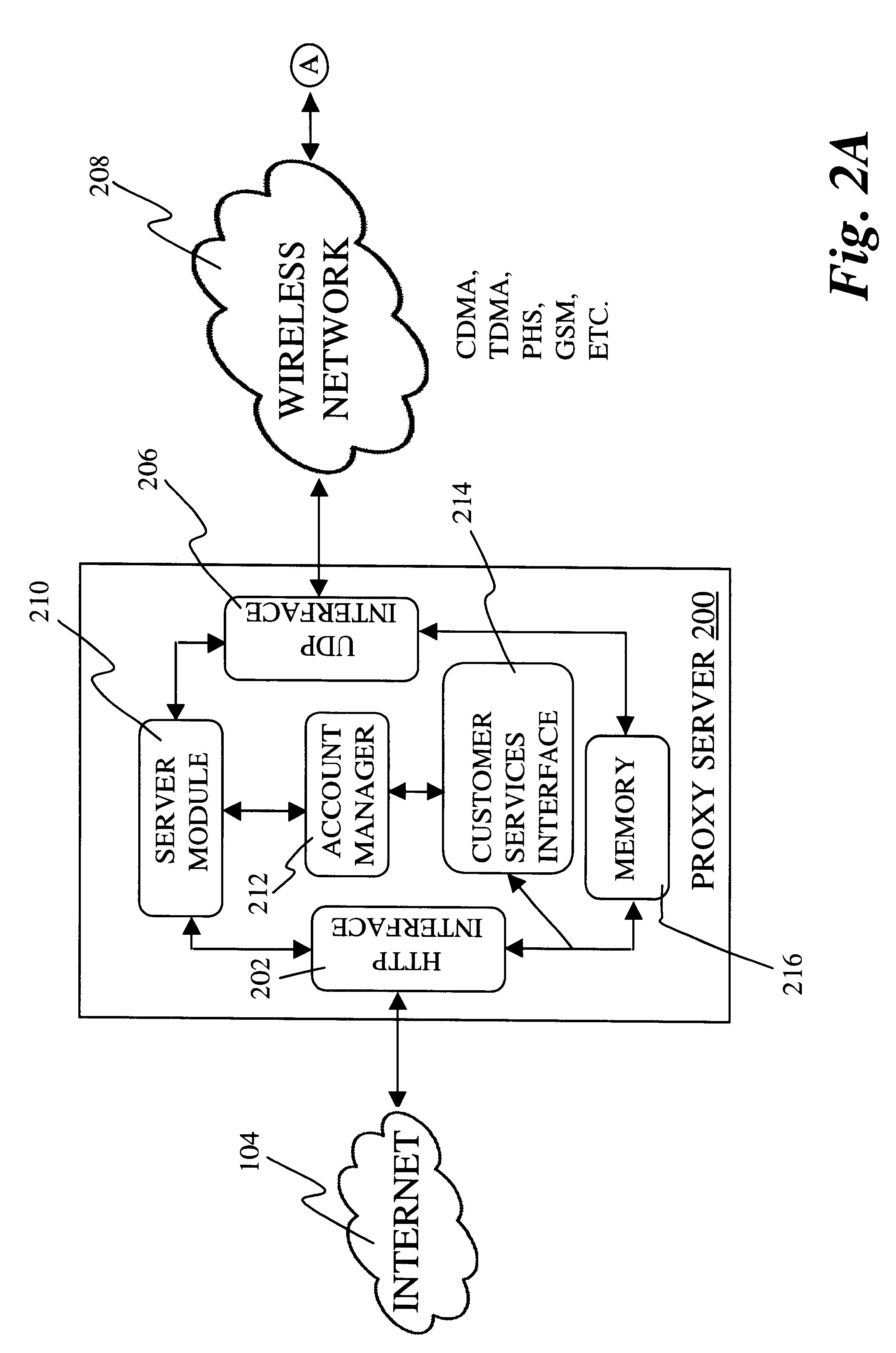

Visual interface to mobile subscriber account services

InactiveUS6466783B2Data switching by path configurationMultiple digital computer combinationsWireless dataPayment service provider

The present invention discloses a method and apparatus for providing visual interfaces to mobile subscriber account services suitable for mobile devices with a small screen and phone keypad communicating, via a wireless data network, with a remotely located server device providing the mobile subscriber account services. Apart from the interactive voice system and other related systems providing access to subscriber account services, the present invention provides direct visual interface to the mobile subscriber account services and allows mobile subscribers to efficiently, visually and interactively, for example, access desired information and place service requests, through the limited screen and phone keypad at anytime from anywhere with limited costs to the service providers and maximum convenience to mobile subscribers.

Owner:UNWIRED PLANET

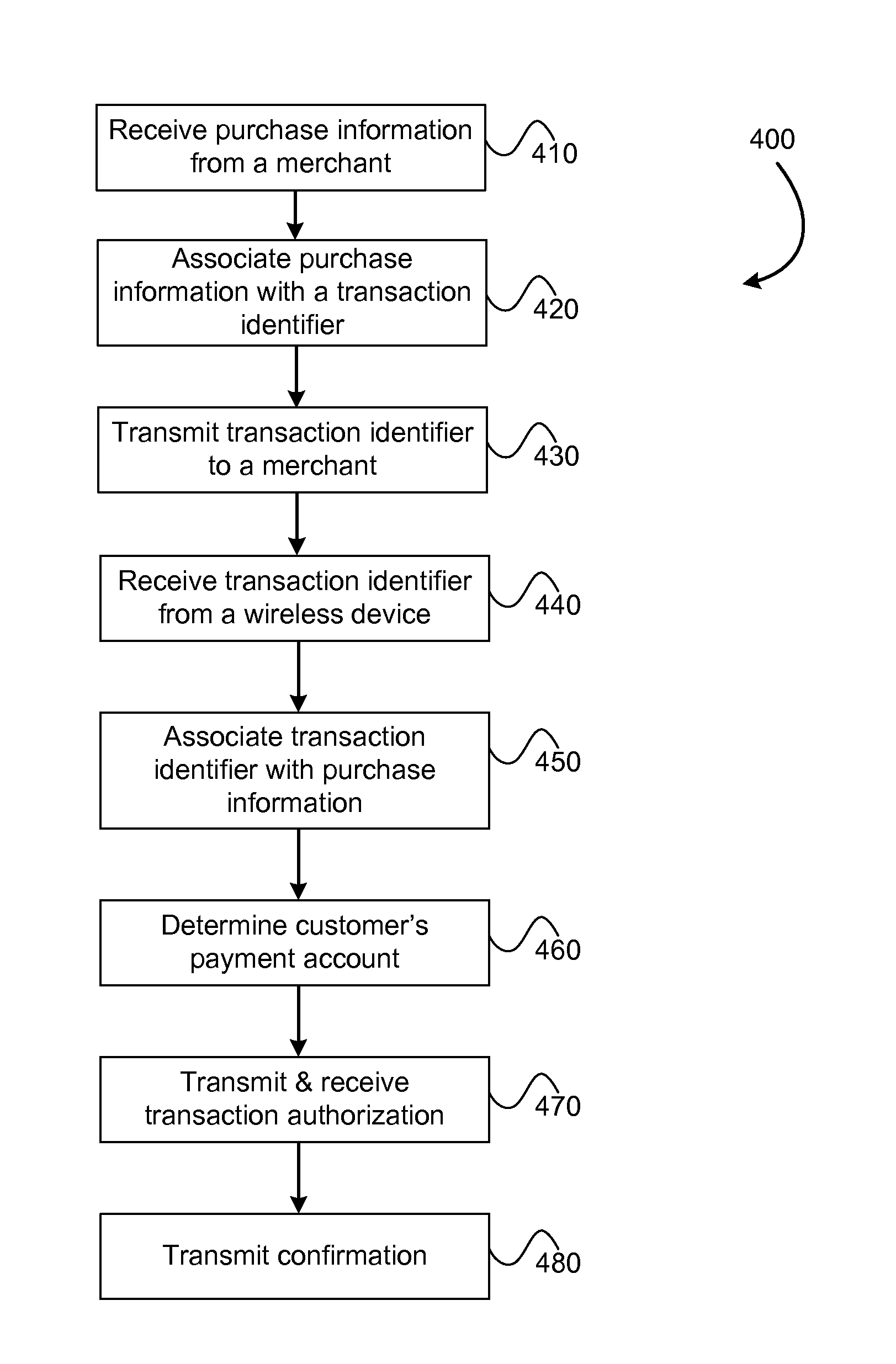

Systems and methods for making a payment using a wireless device

ActiveUS20130073365A1Cryptography processingBuying/selling/leasing transactionsPayment transactionPayment service provider

Embodiments of the invention provide methods and systems for performing a payment transaction. A method for performing a payment transaction may include receiving purchase information from a merchant and associating the purchase information with an identifier. The method may also include transmitting the identifier to the merchant and receiving the identifier from a wireless device of a customer. The wireless device may obtain the identifier by receiving a code from a merchant device and by interpreting the code. The method may additionally include associating the identifier with the purchasing information, determining a payment account associated with the customer, transmitting a request to a payment service provider system to provide funds for the payment transaction, and receiving an authorization from the payment service provider system to provide the funds. The method may additionally include transmitting a confirmation of the authorization to the merchant.

Owner:FEXCO

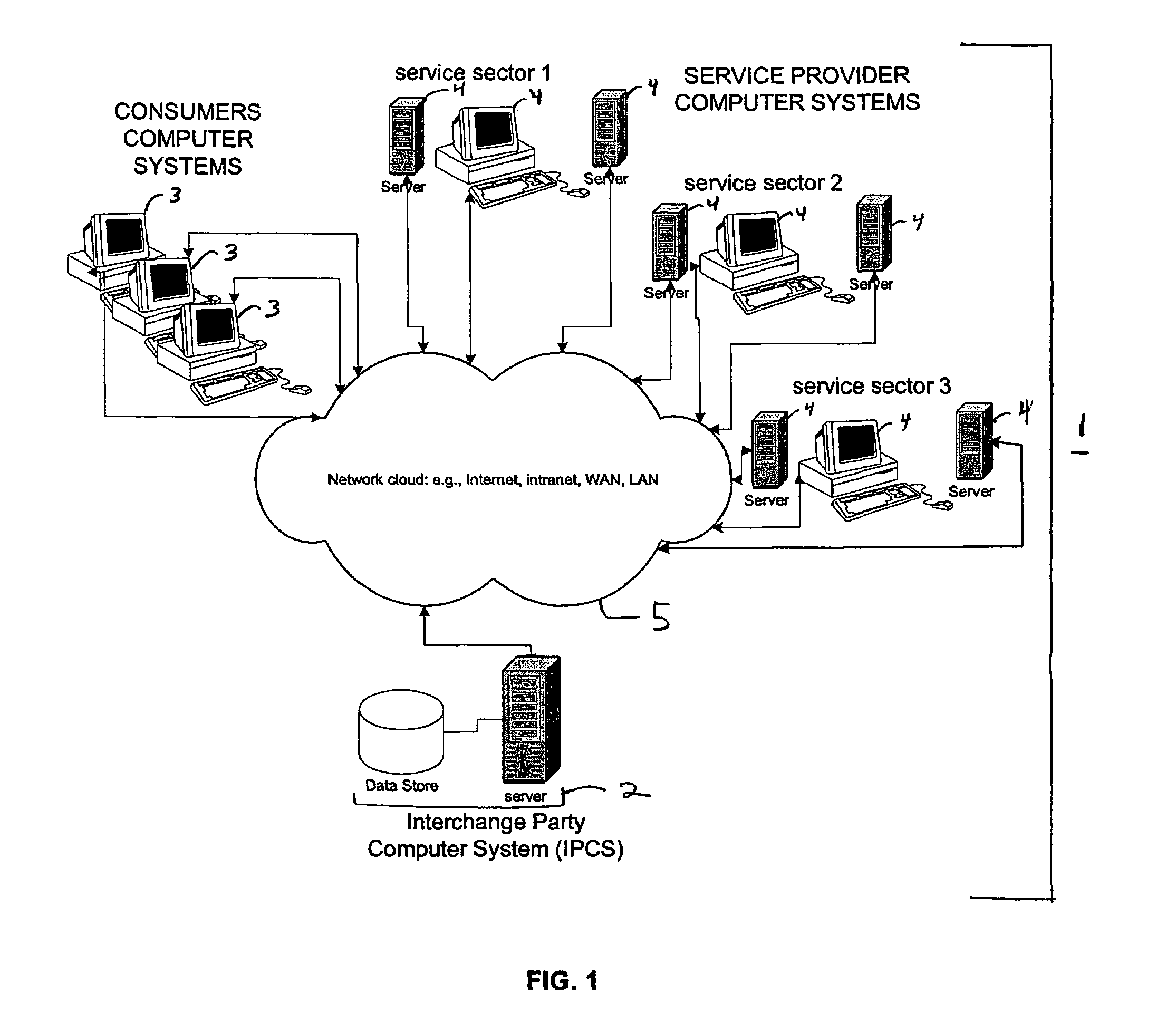

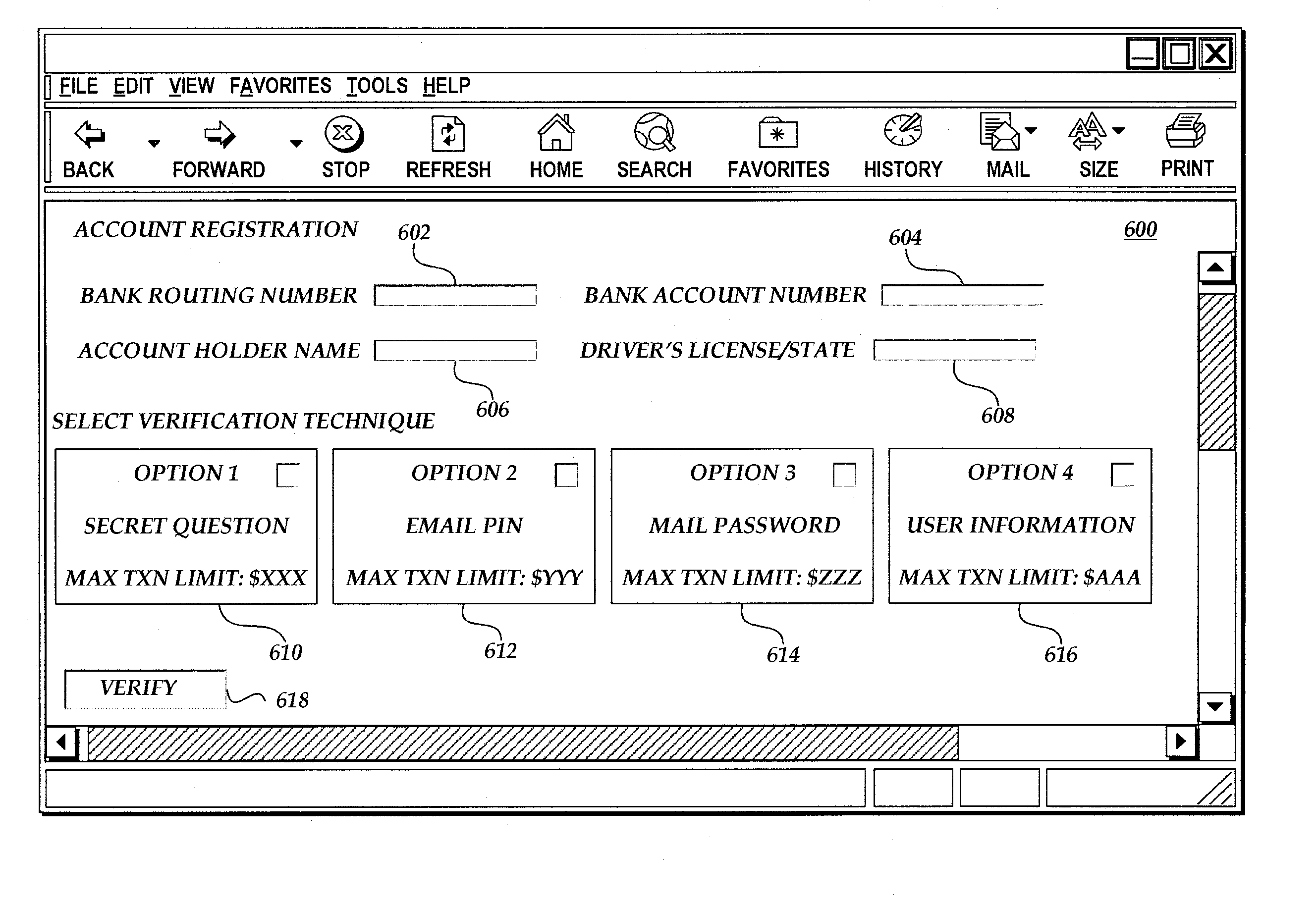

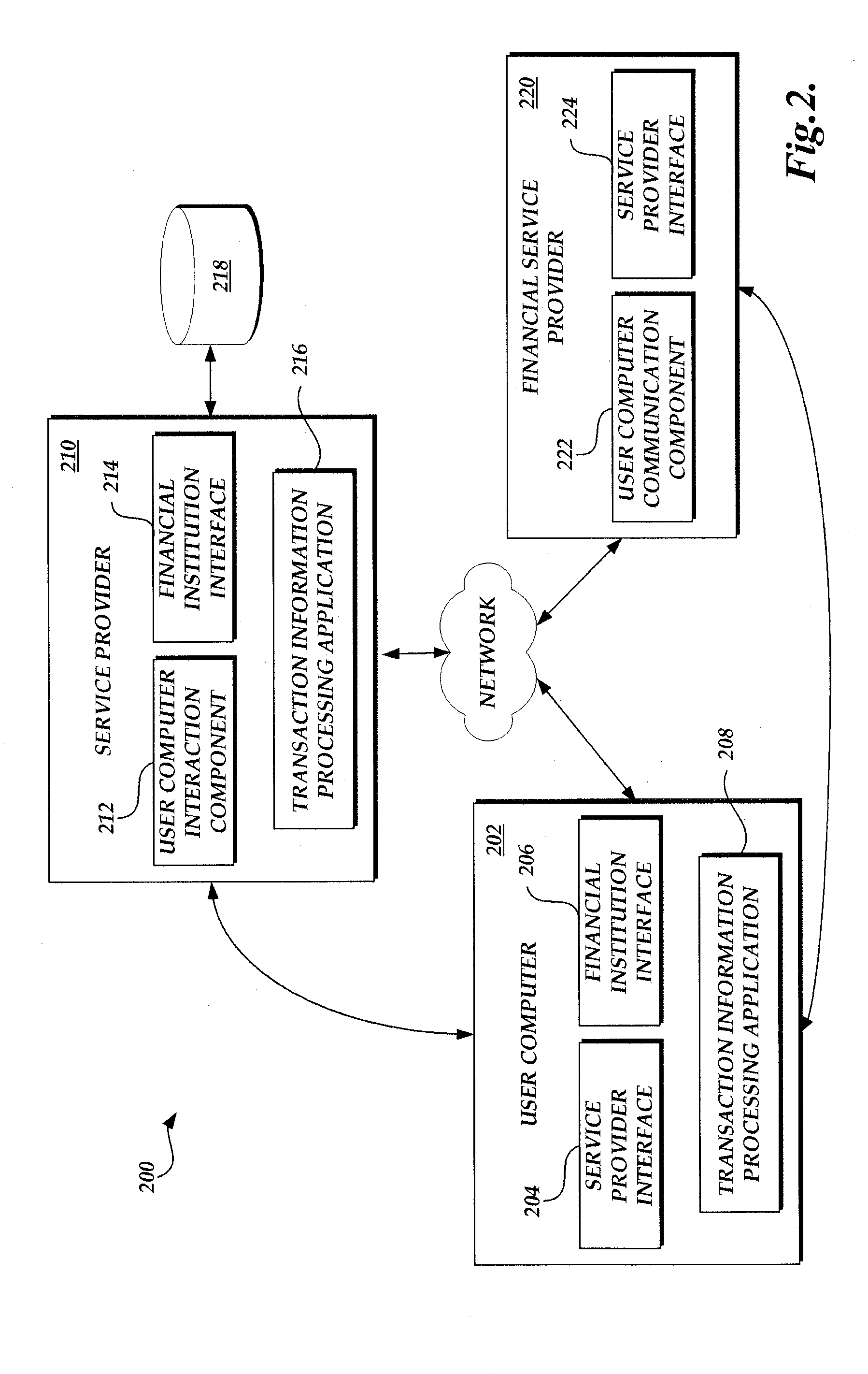

Systems and methods for online selection of service providers and management of service accounts

InactiveUS7139728B2Free consumers and businesses from time-consuming, tedious processes of paying billsHand manipulated computer devicesAdvertisementsService provisionComputerized system

An interchange party computer system (IPCS) having means for presenting user interfaces to consumer computer systems and capturing data input through the user interfaces, the IPCS being associated with at least one database holding data representing a plurality of consumer profiles, the profiles including consumer profiles expressing service selection attributes for a plurality of service sectors, and at least one database holding data for a plurality of service programs under a plurality of service sectors, each sector being represented by service programs from a plurality of service providers, the IPCS including (a) a Service Comparison / Selection Module; (b) an Automatic Bill Payment Module; (c) an Automated Services Monitoring Module; (d) an Automated Best Services Selection Module; (e) a Services Search Module; (f) an Incentive Program Module; (g) a Data Mining Module; and / or (h) a Pooling Module.

Owner:MIND FUSION LLC

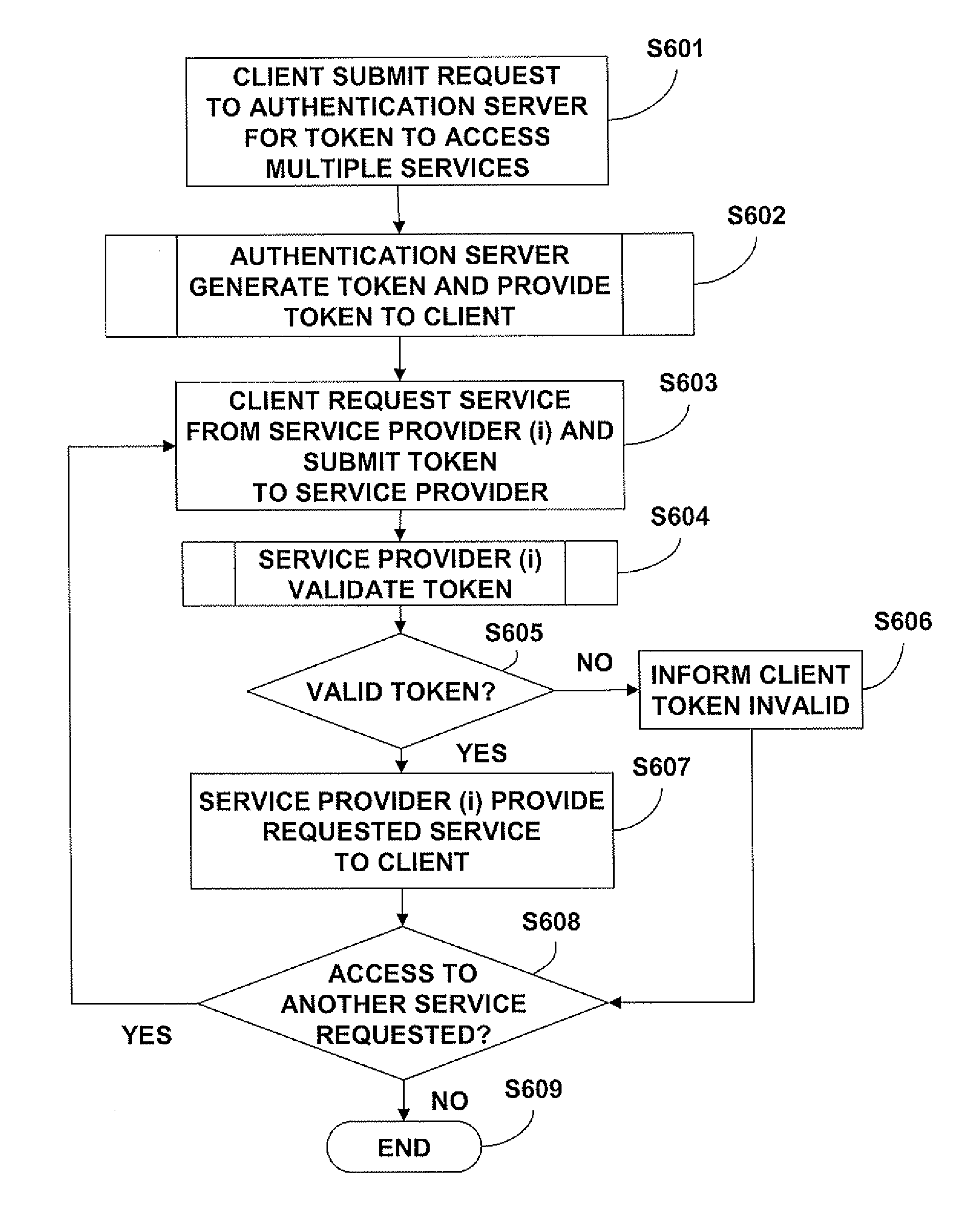

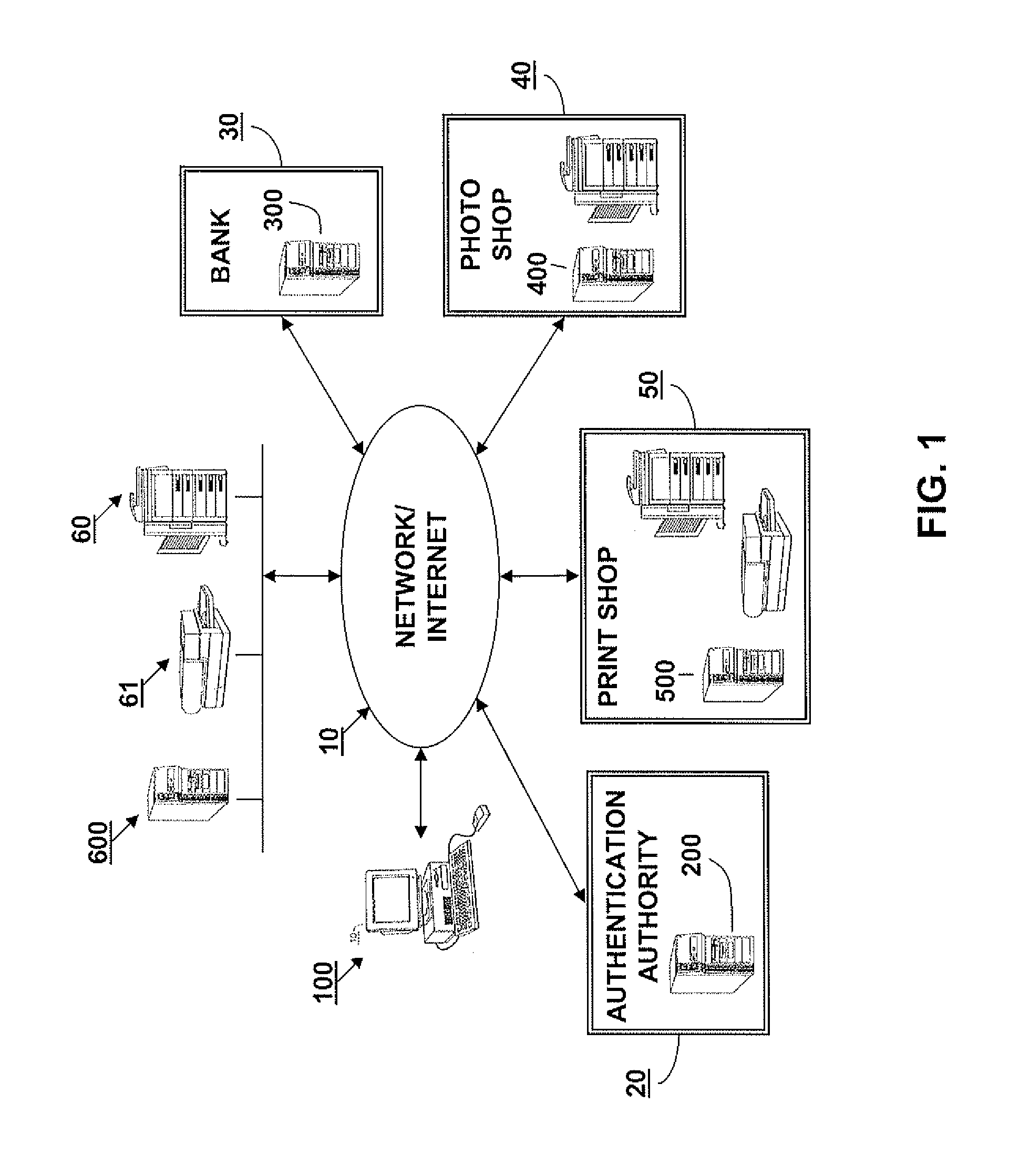

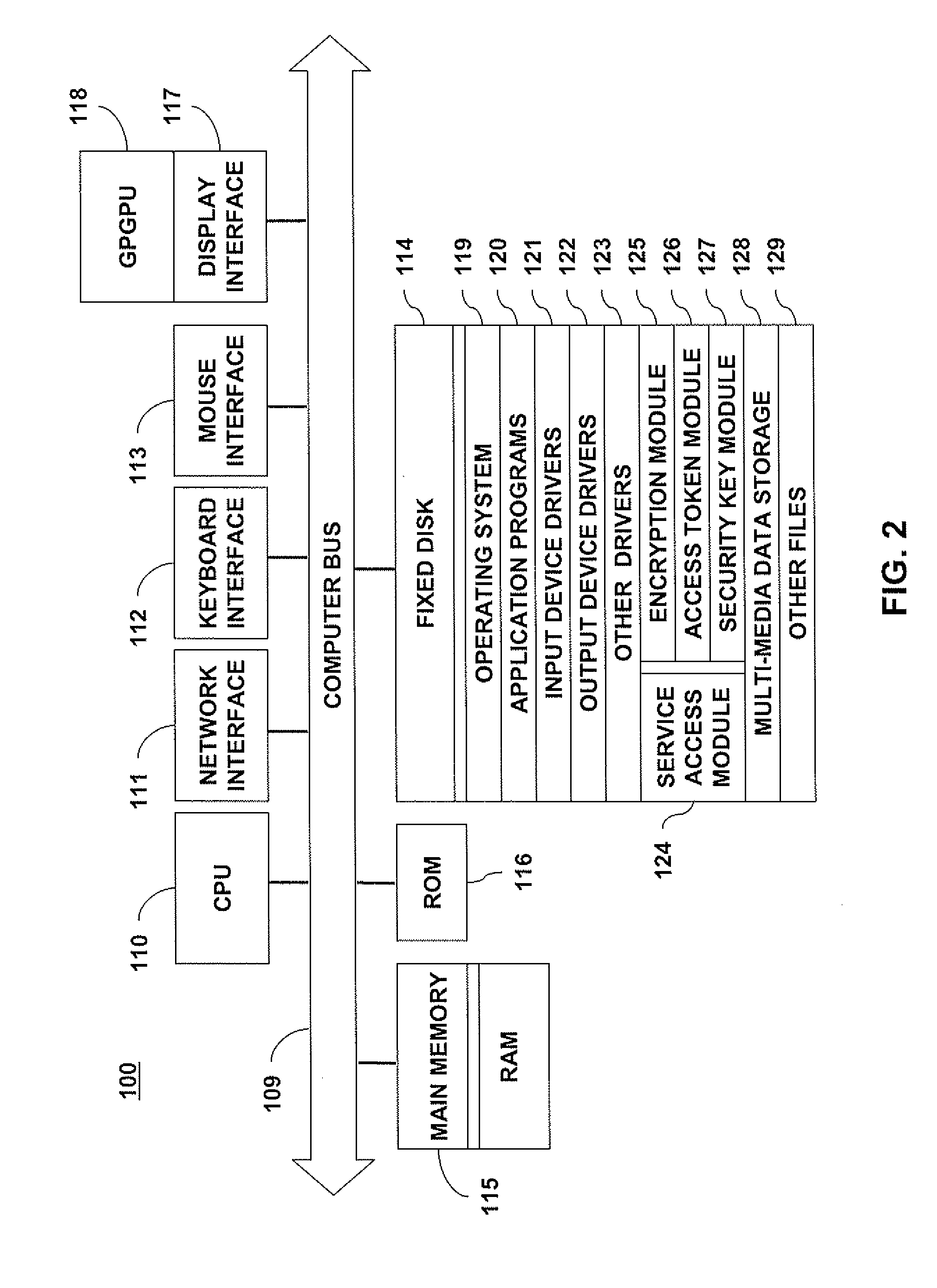

Security token destined for multiple or group of service providers

InactiveUS20110239283A1Easy to useEliminate needDigital data processing detailsUser identity/authority verificationAuthentication serverWorkstation

An authentication server generates a security token to be used by a client for accessing multiple service providers by obtaining a secret key for each specified service provider, generating a saltbase, generating a salt for each service providers using the saltbase, the secret key, and a hashing algorithm, generating a session key that includes the salt, assigning an order to each of the generated salts, and arranging the salts based on the orders, generating a presalt for each provider using the salt for each previous provider, generating a postsalt for each of the specified service providers using the salt for each following provider, generating a blob for each of the specified service providers using the saltbase, the respective presalt, and the respective postsalt, inserting the generated blobs for the specified service providers in the security token, and providing the generated security token to the client workstation.

Owner:CANON KK

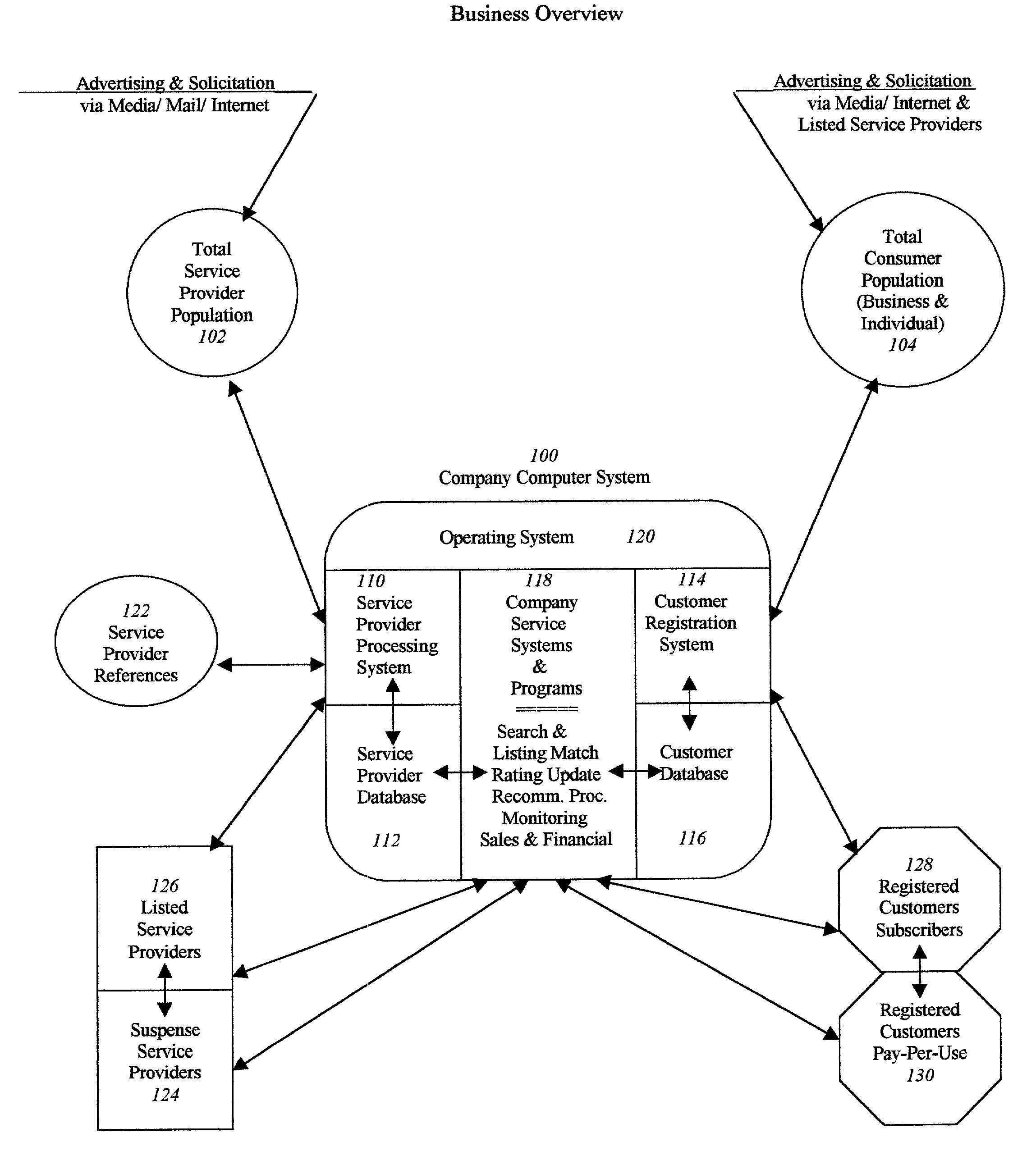

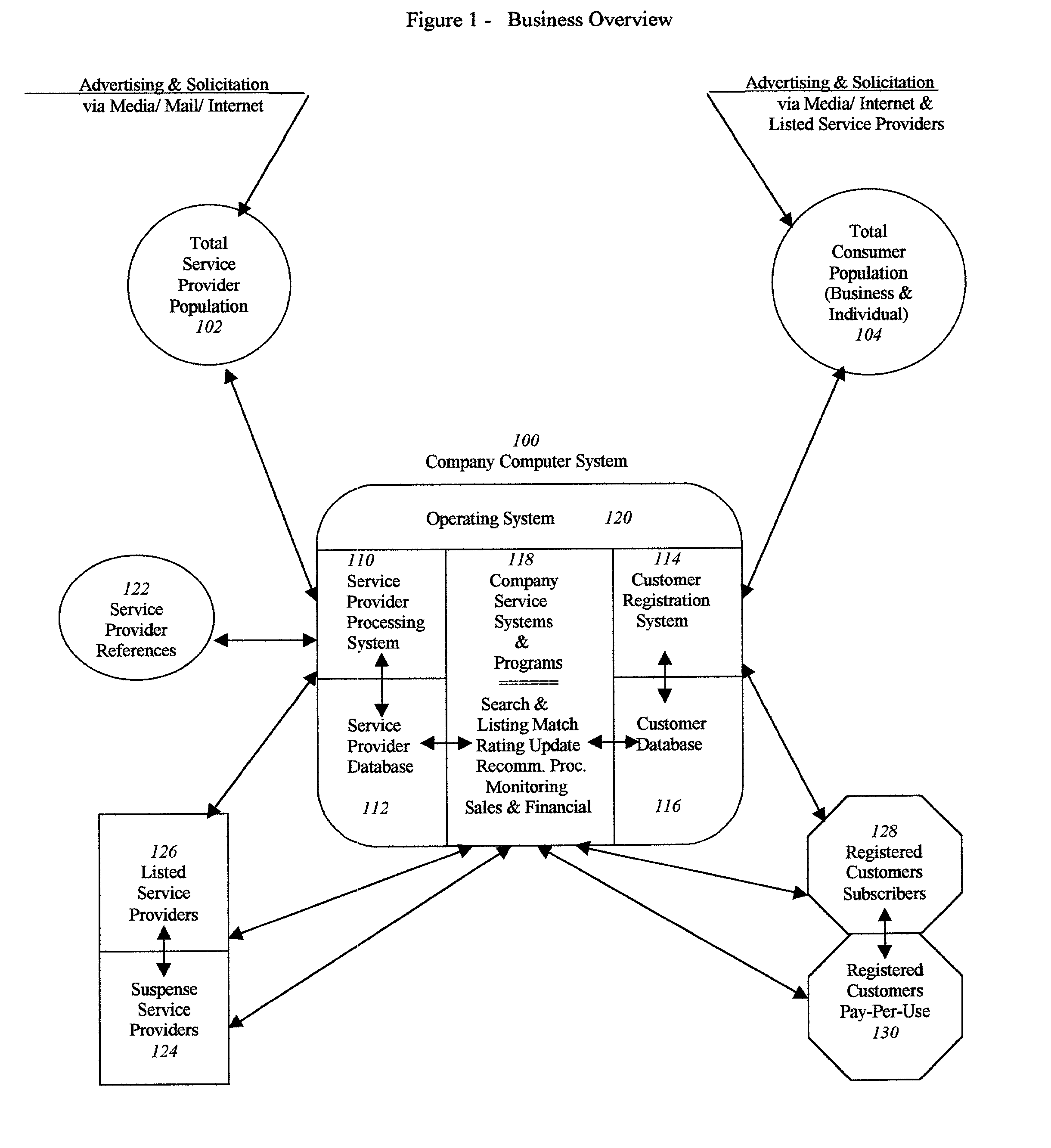

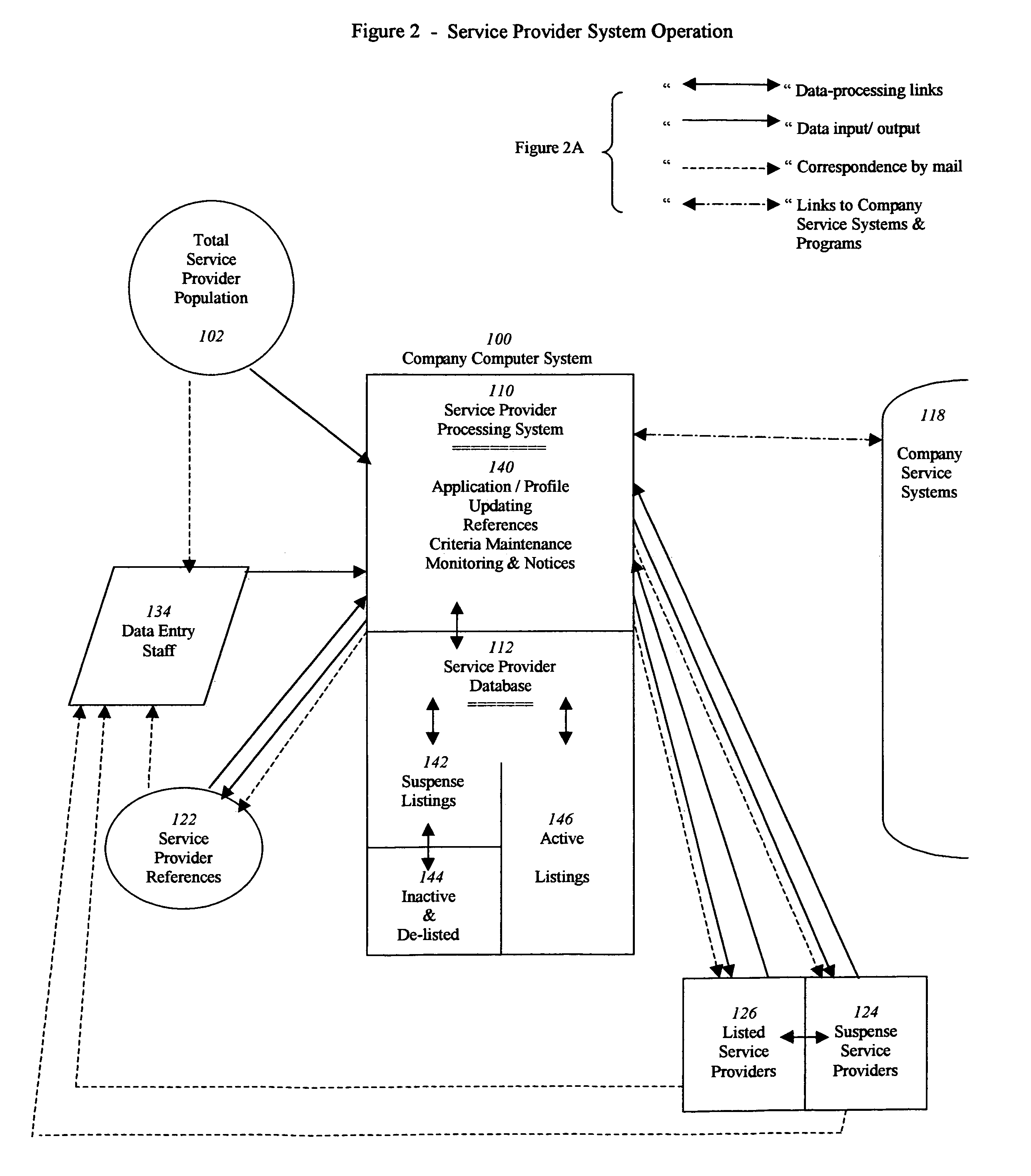

Accessible service provider clearinghouse

A service that maintains a minimum criteria level for service providers to be listed and available for public access. It can list not only the service provider's credentials and insurance support (with monitored expiration dates), but may also provide a current up-to-date rating system by the users themselves, as to the satisfaction level of the quality and reliability of the work performed. It can also offer a double-check of the credentials by customer verification input. Furthermore, the example service can be easily accessible by the general public (for individual or business use) on the Internet, or by printed text directories sold direct or in bookstores.

Owner:LOKITZ SHEILA

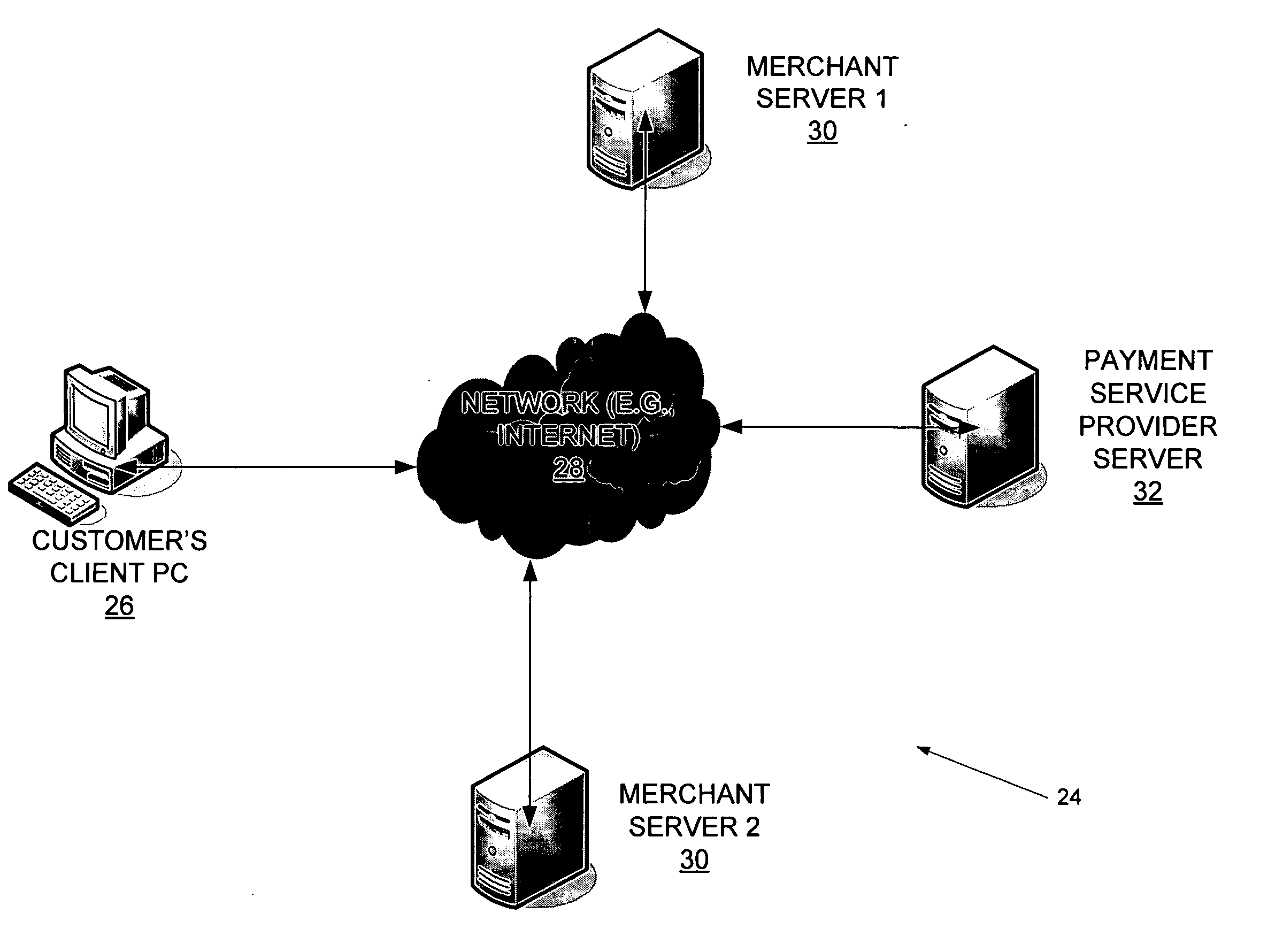

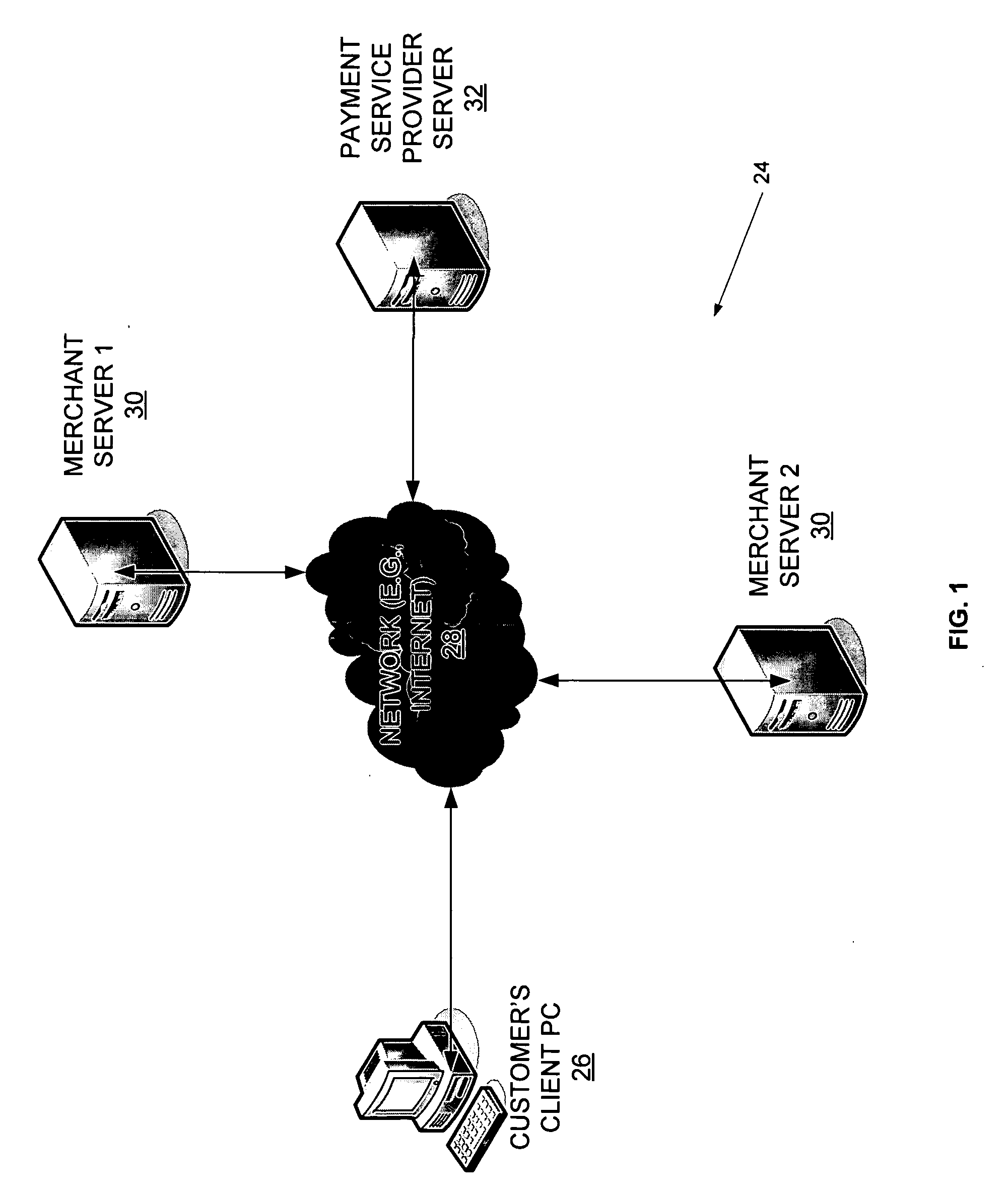

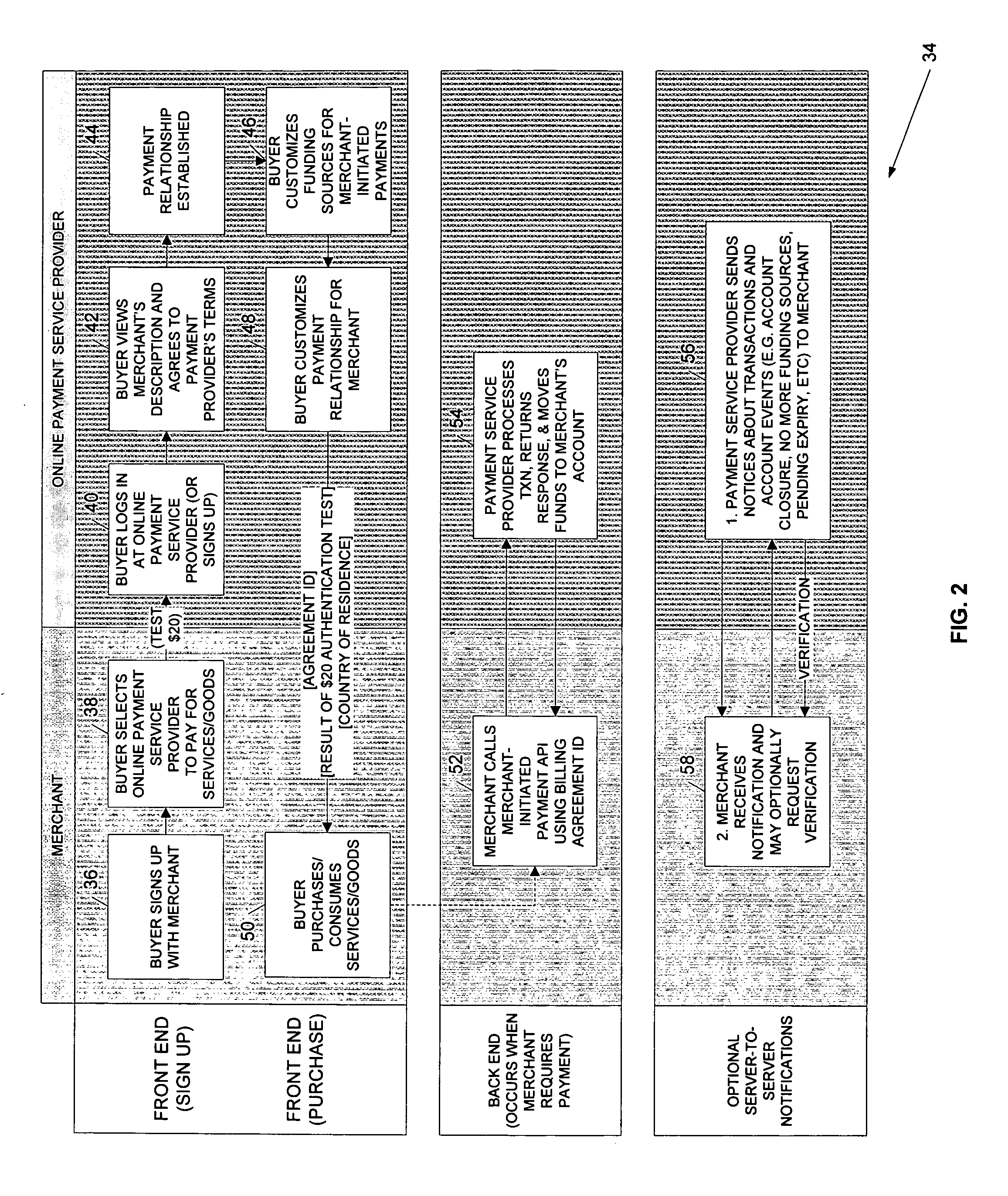

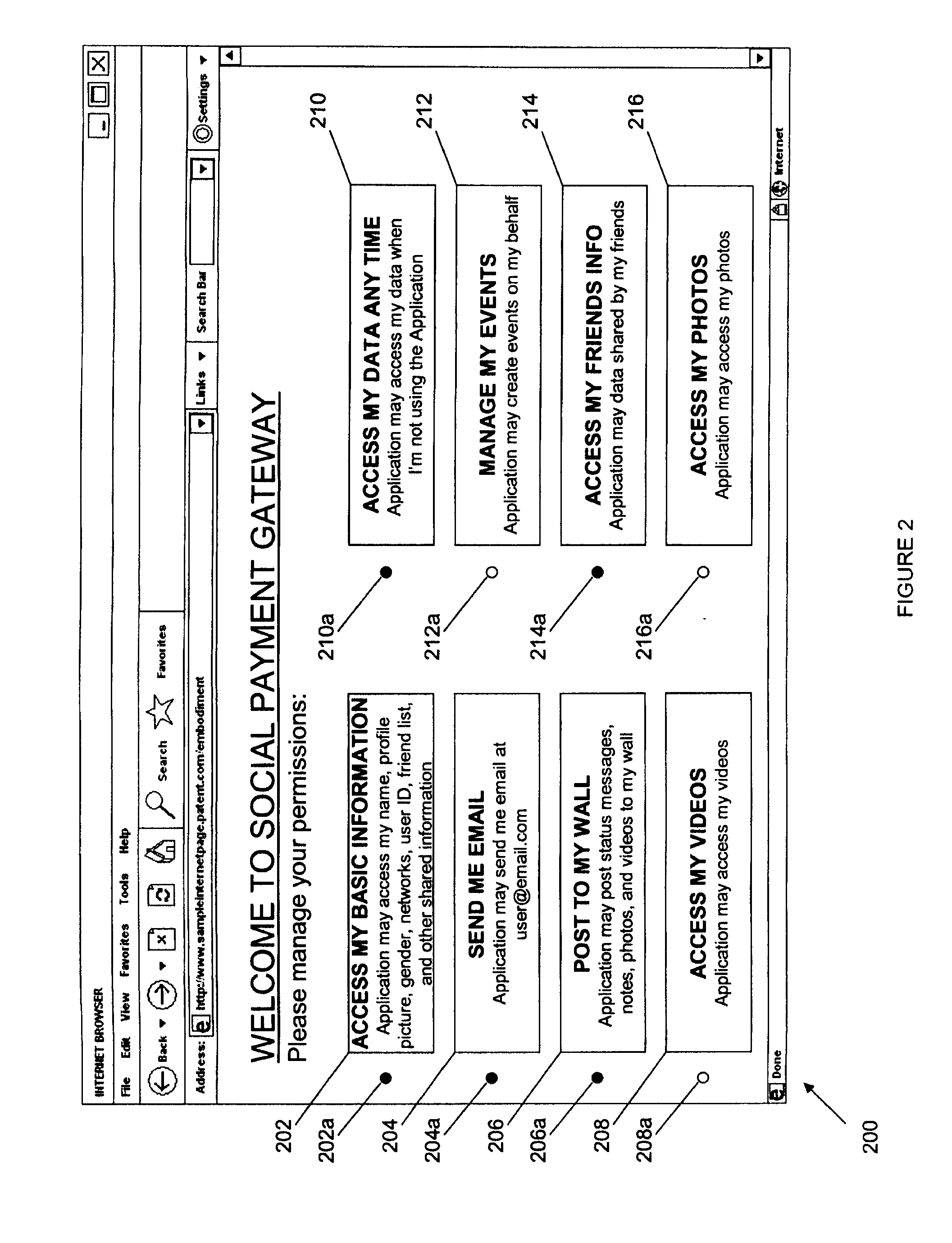

Method and system for facilitating merchant-initiated online payments

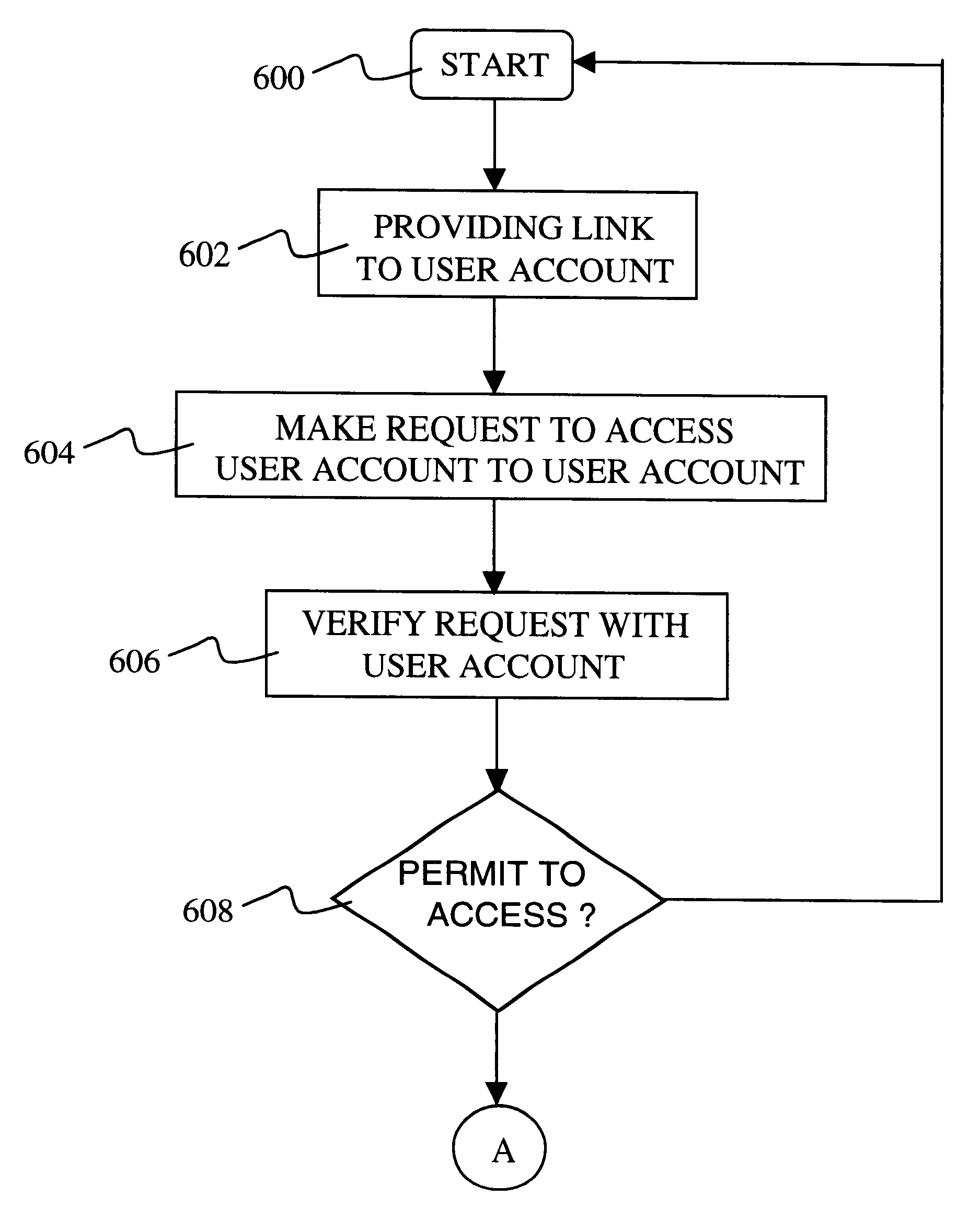

A method and system for facilitating merchant-initiated online payments are disclosed. According to one aspect of the present invention, a payment service provider's server receives a user's request, via a merchant's server, to establish a merchant-initiated payment relationship or agreement. Accordingly, the payment service provider presents the user with options to customize the terms of the merchant-initiated payment agreement. After the agreement has been established and the terms customized, the merchant server communicates a merchant-initiated payment request to the pavement service provider for a transaction entered into with the user. The payment service provider's server processes the payment request after verifying that processing the payment does not exceed the user-customized terms of the agreement.

Owner:PAYPAL INC

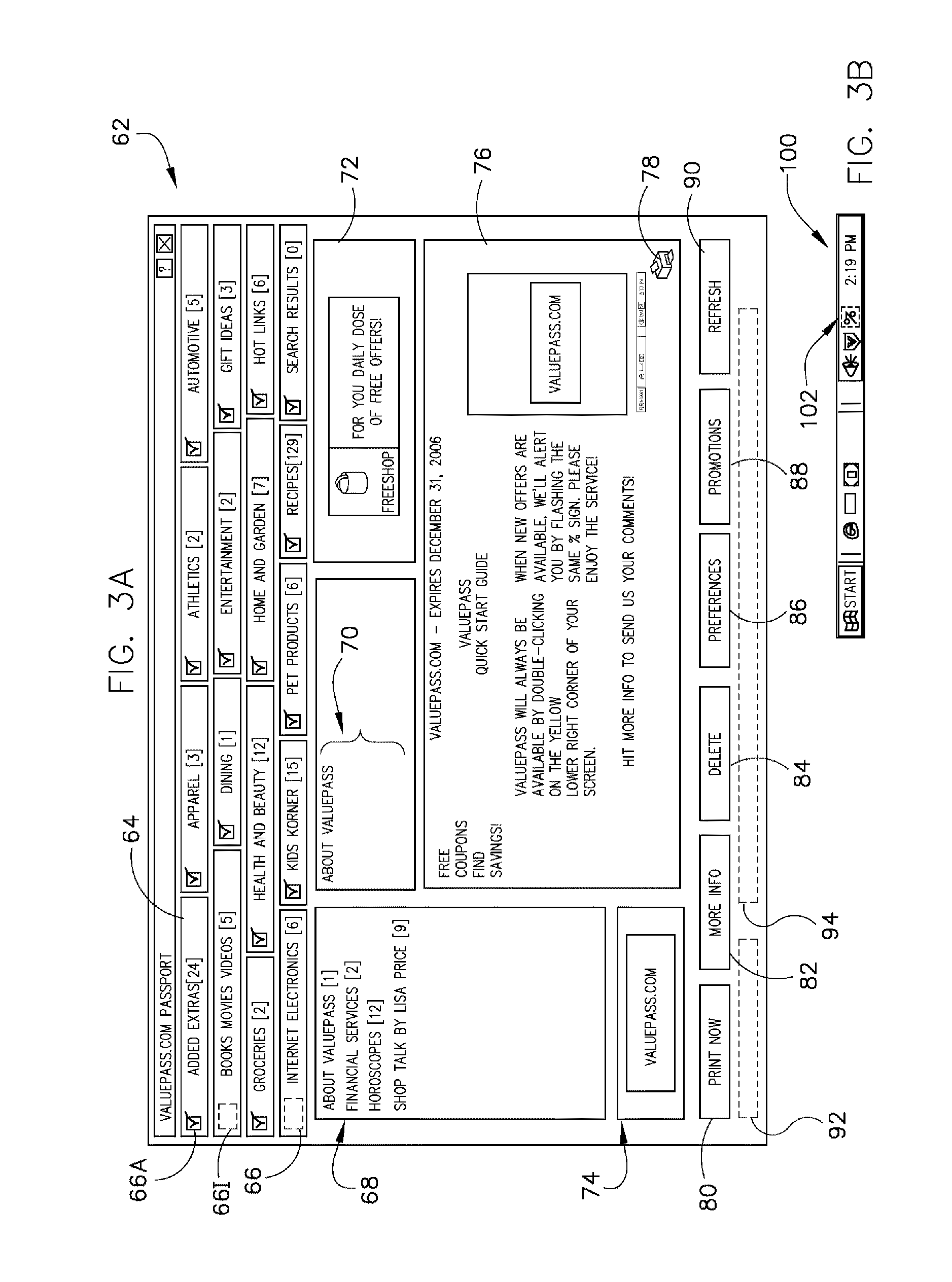

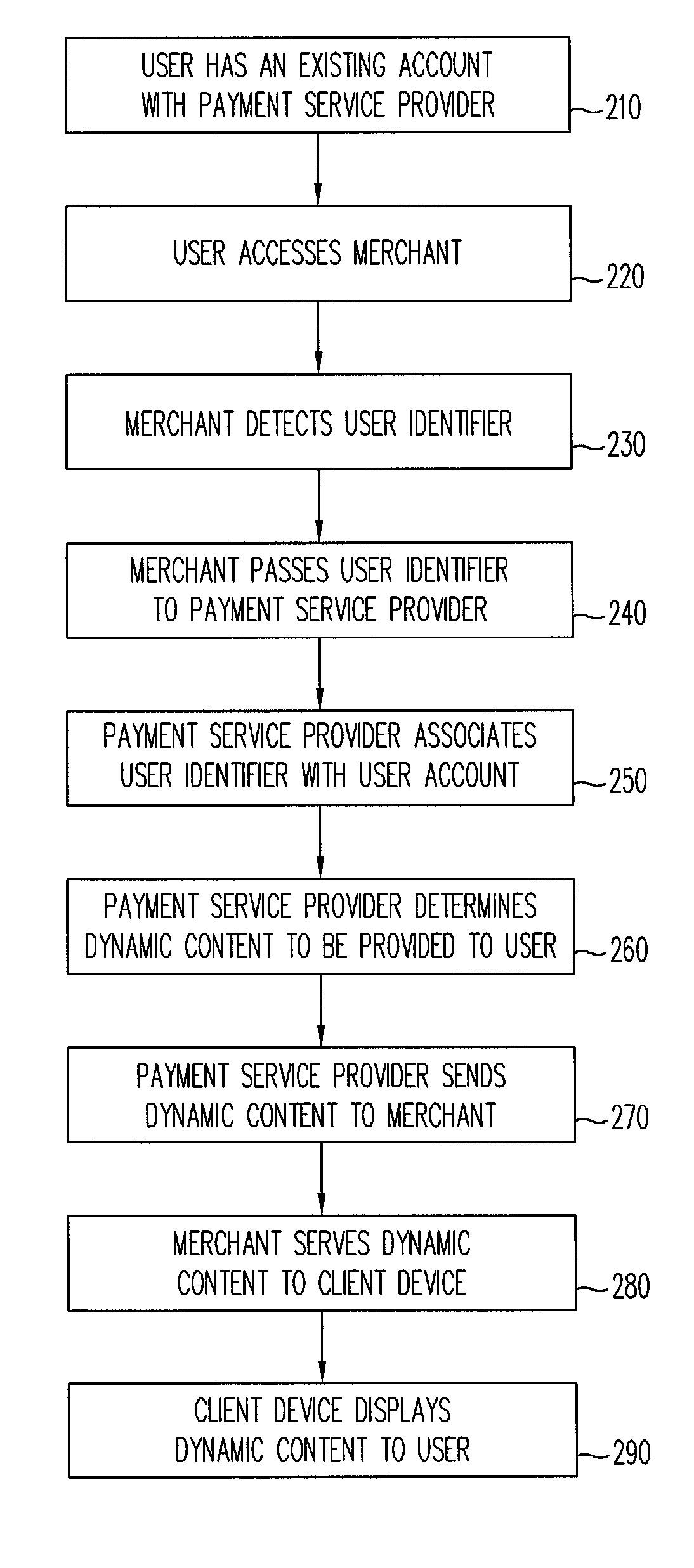

Dynamic content for online transactions

ActiveUS20070245022A1Promote disseminationFinanceMultiple digital computer combinationsClient-sideUser identifier

Various methods and systems are disclosed to provide dynamic content to users of online payment service providers without requiring users to log in or otherwise actively engage the payment service providers. In one example, a method of providing dynamic content includes providing a client device with access to an online marketplace over a network. The method also includes facilitating transmission of a user identifier stored by the client device to a payment service provider. The method further includes receiving dynamic content from the payment service provider in response to the user identifier. In addition, the method includes serving the dynamic content to the client device over the network.

Owner:PAYPAL INC

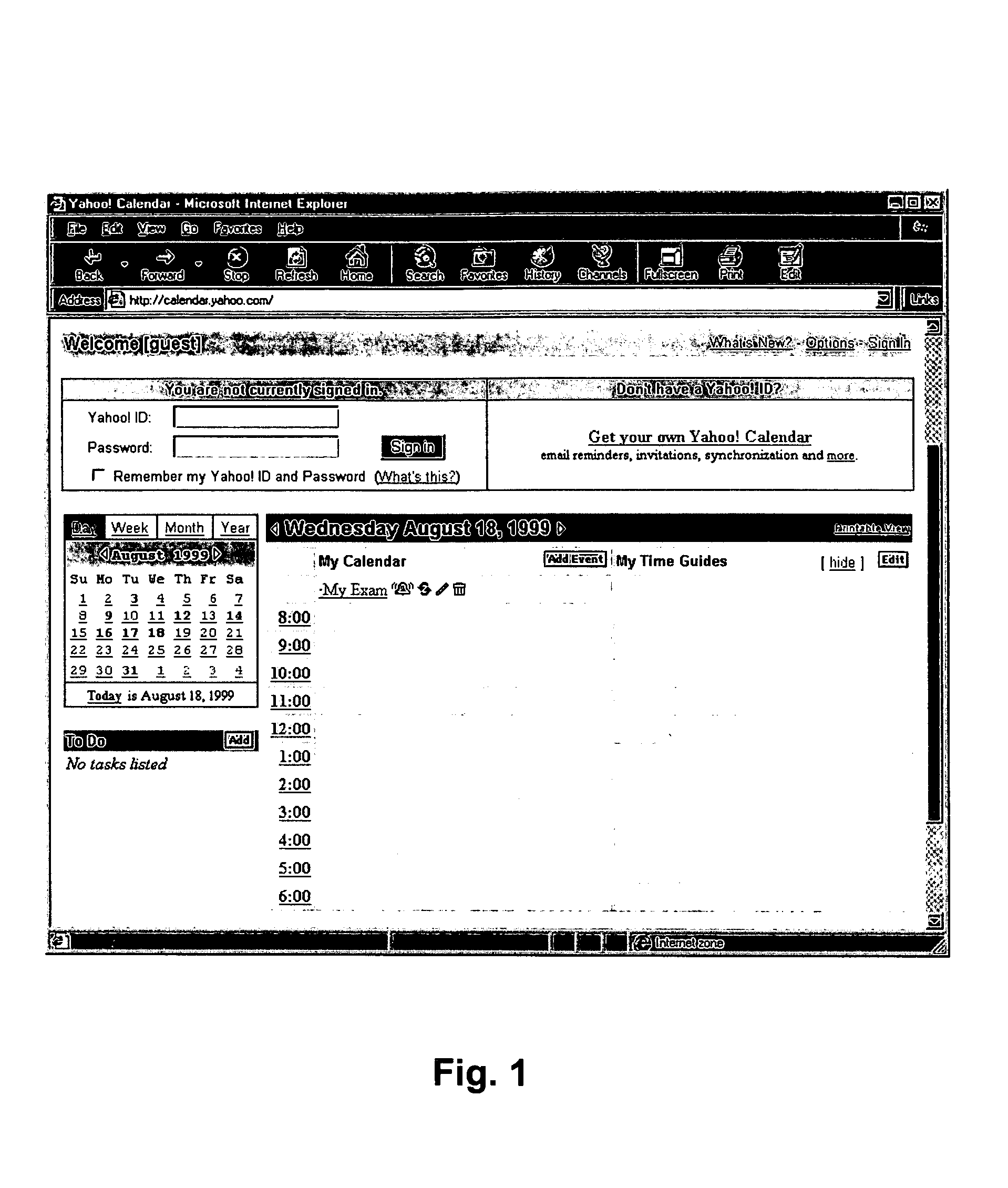

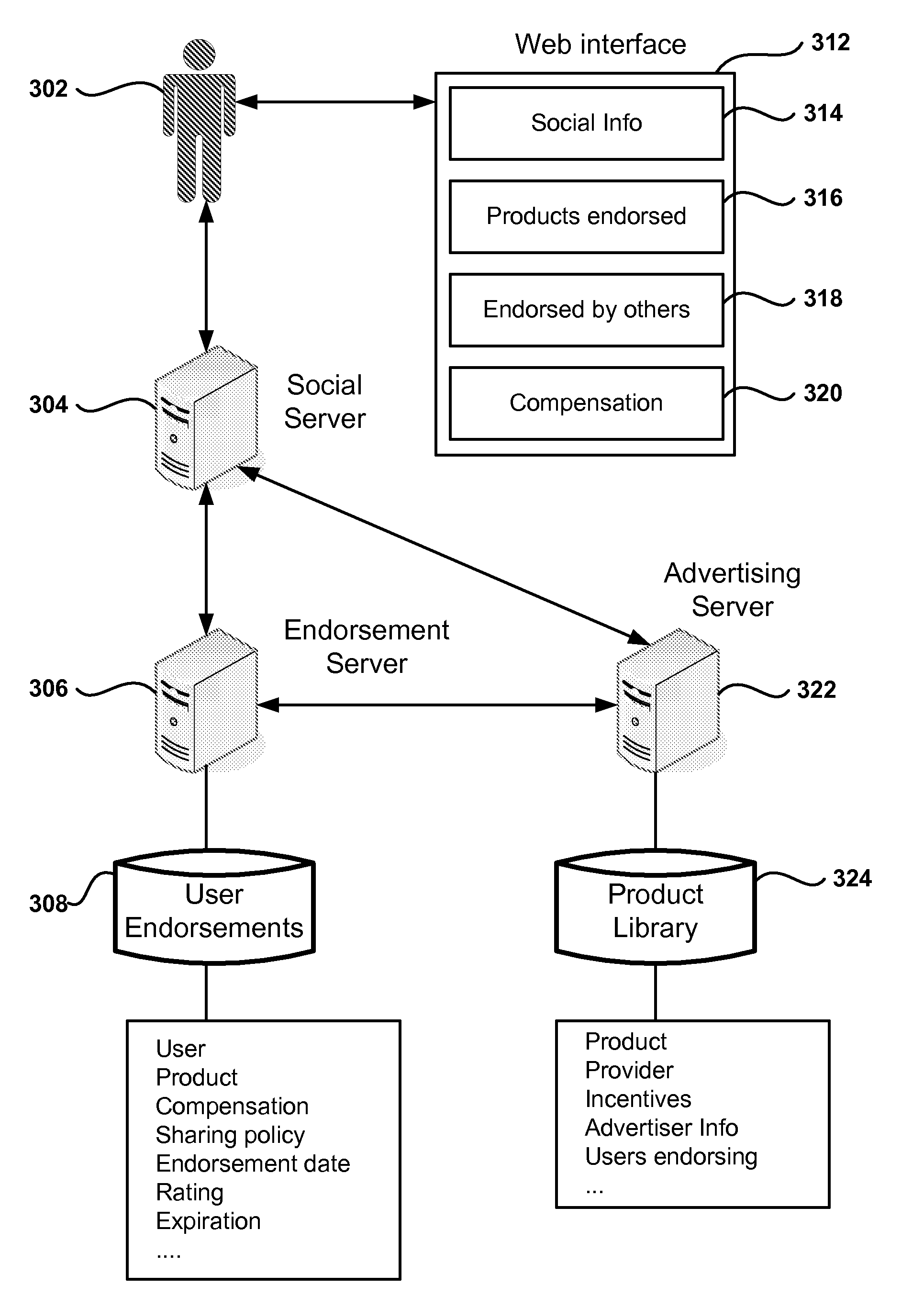

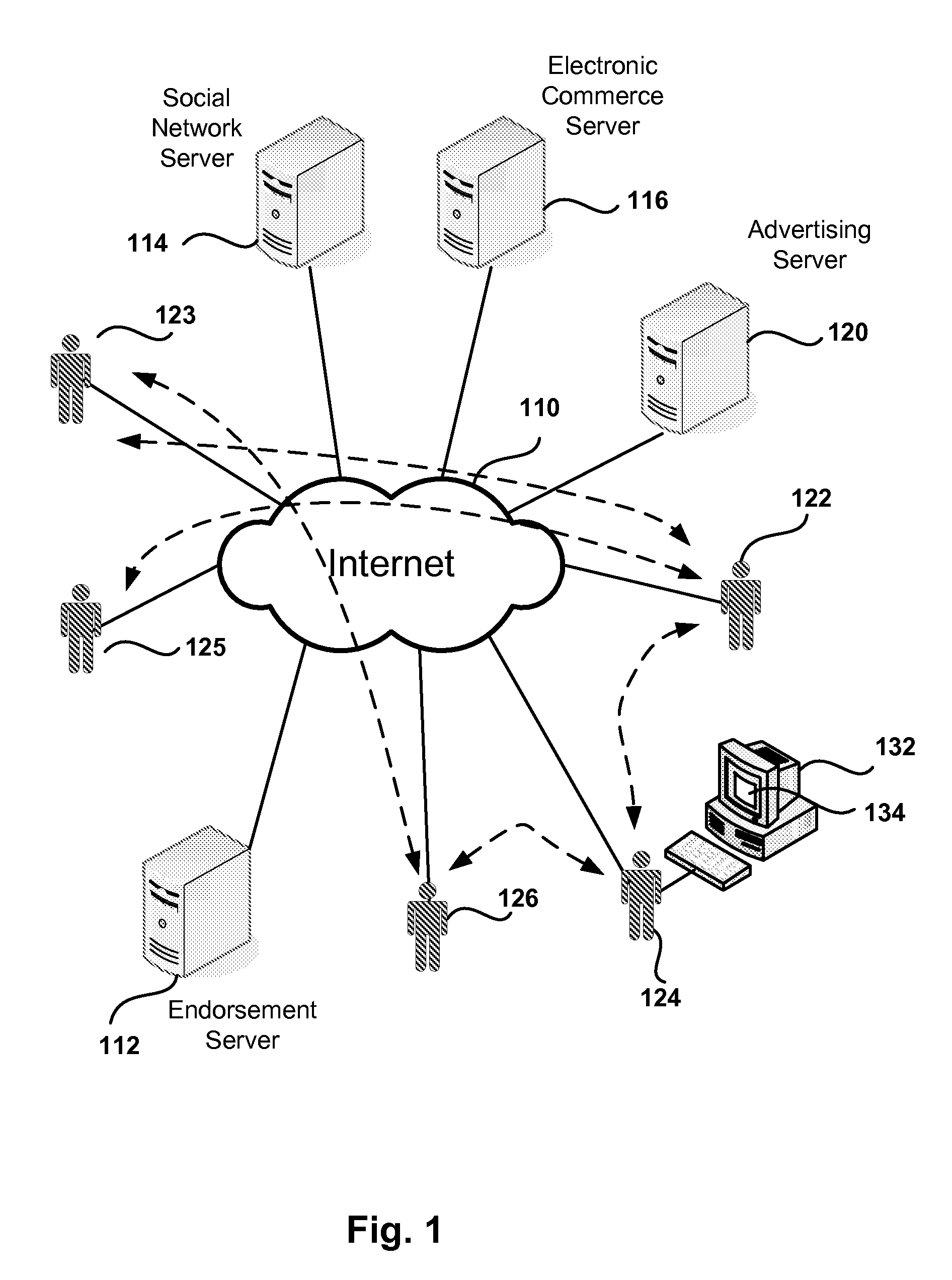

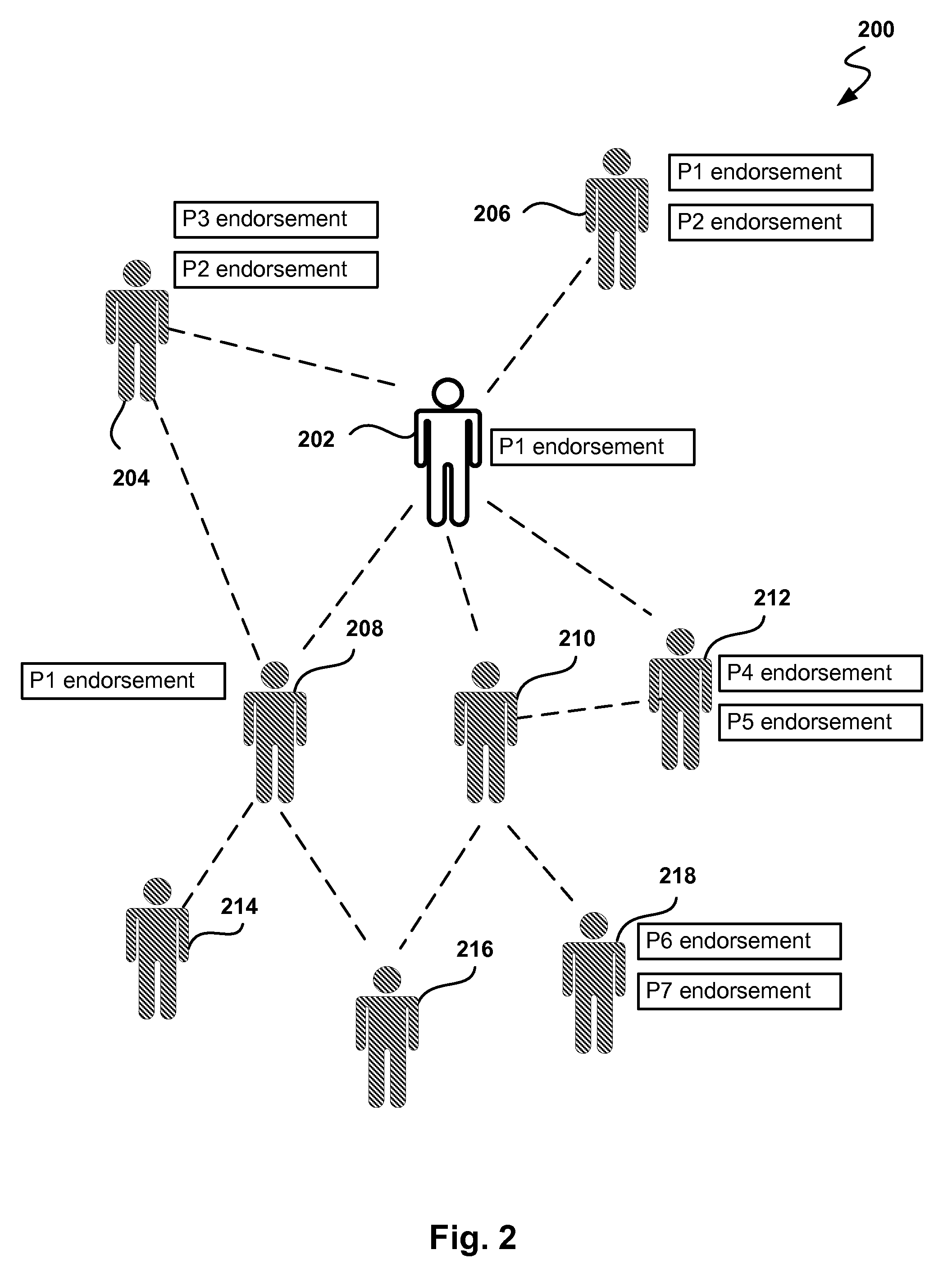

Advertising Through Product Endorsements in Social Networks

Systems, methods and computer programs for creating a web user interface promoting products or service providers are provided. The method includes the creation of a library of products and service providers. Endorsements for products and service providers are generated by users of a social network that includes a social web site. The users create rules for sharing the endorsements with other users in the social web site or beyond the social web site. The user interface is built for a particular one of the users in the social web site, where the user interface includes a representation of the product or service provider associated with the endorsements. The user interface is created according to rules from the user that generated the object, rules by the user viewing the endorsement, and rules by a sponsor of the product or service provider associated with the endorsement. The user interface is then shown in a display.

Owner:YAHOO INC

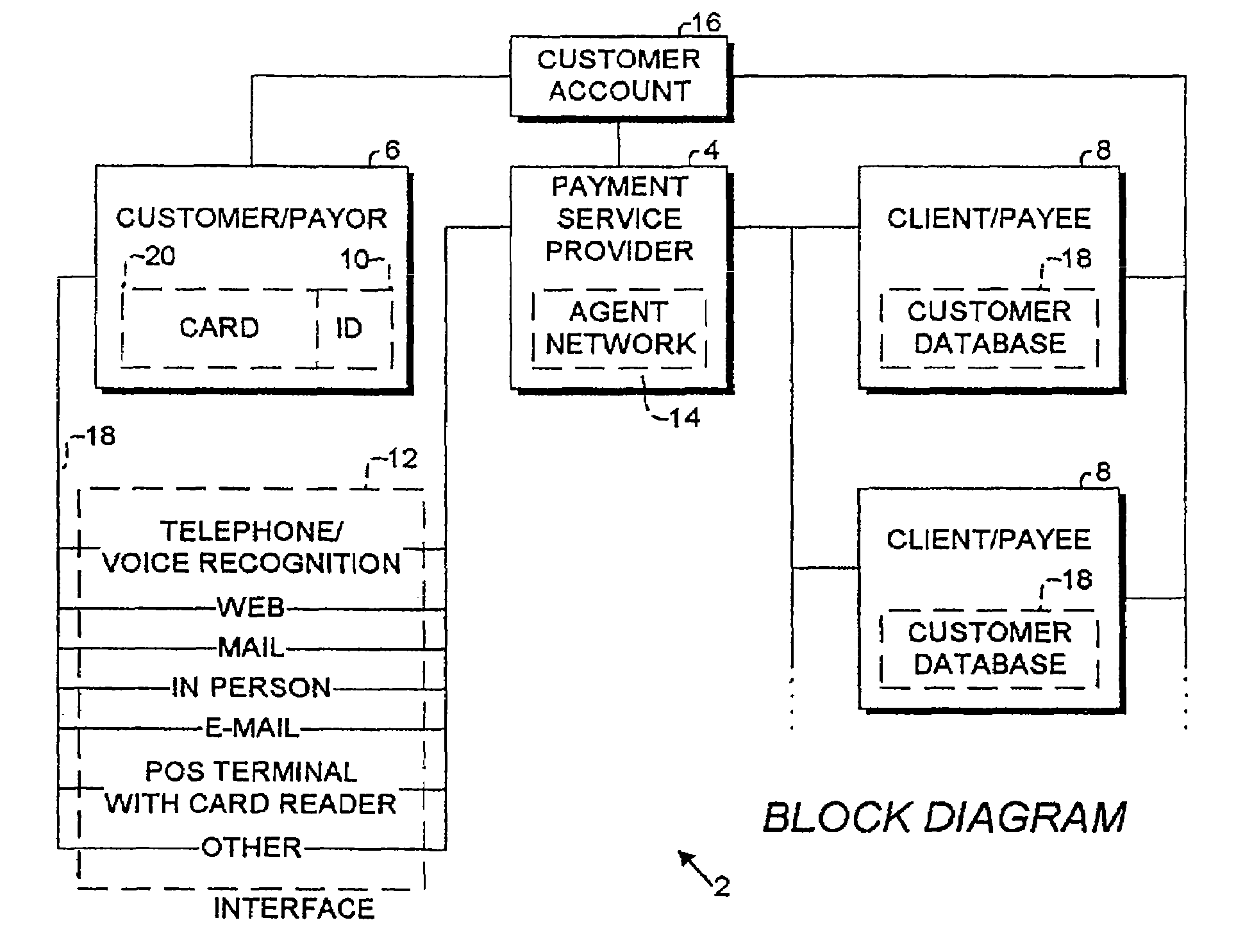

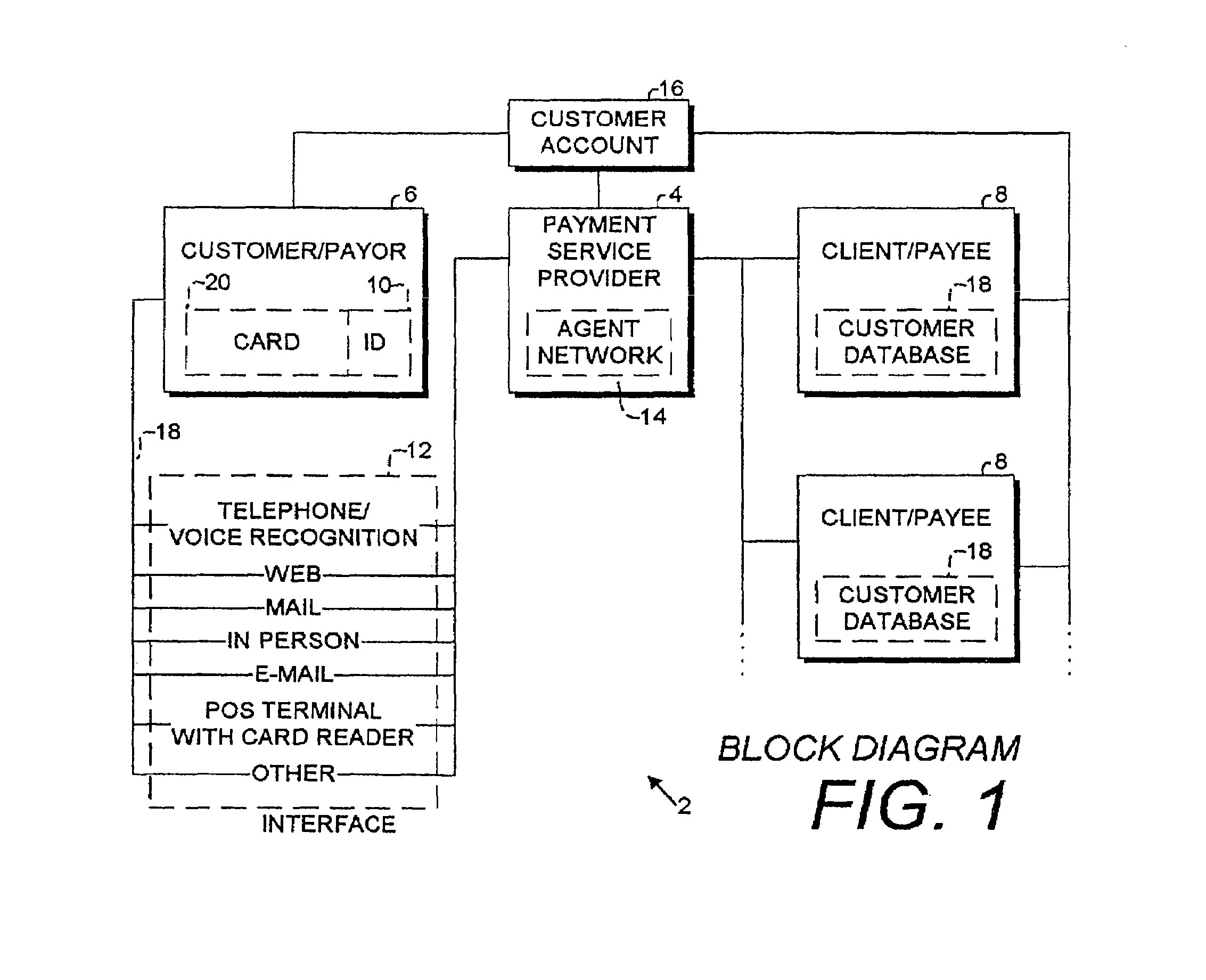

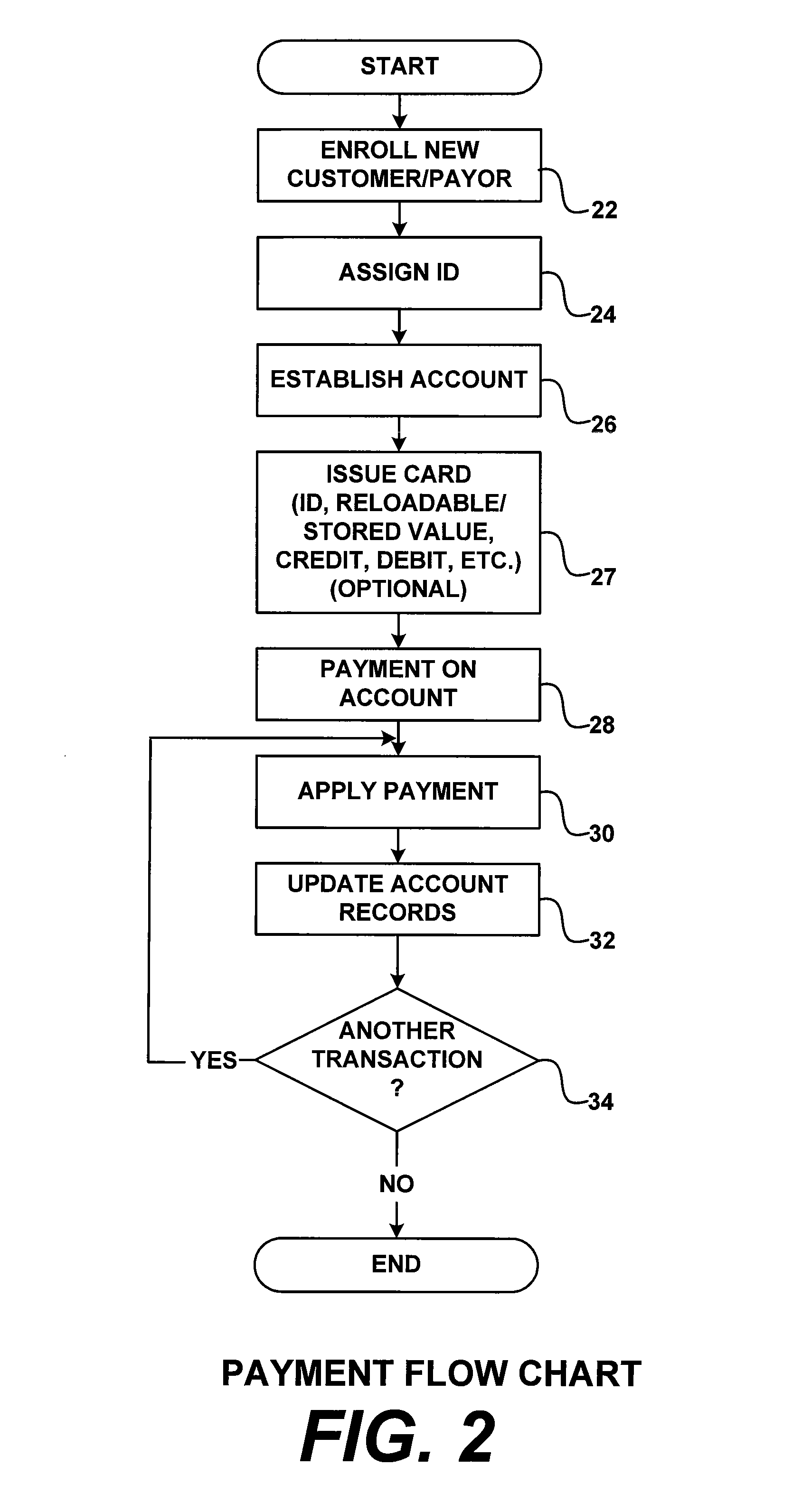

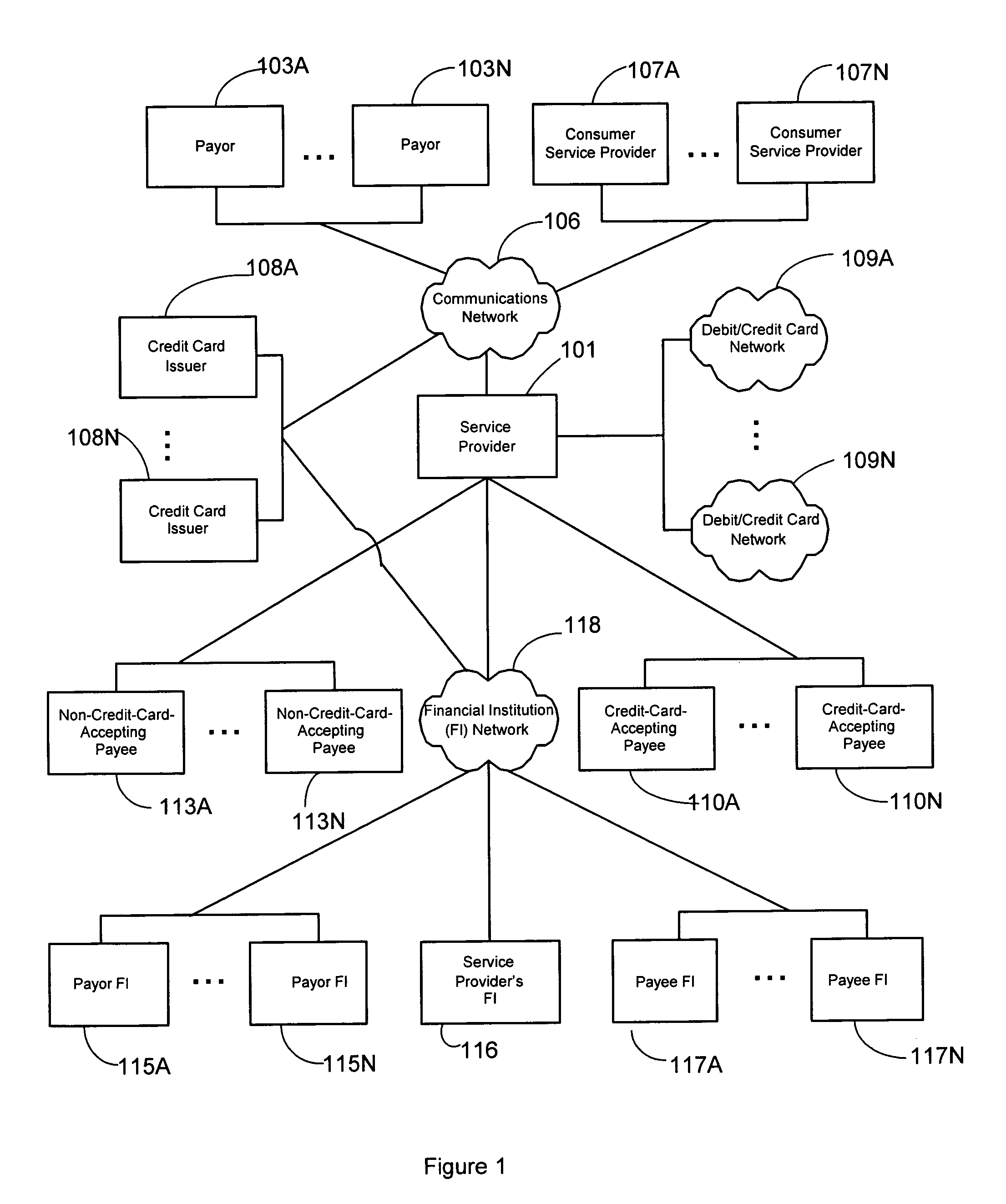

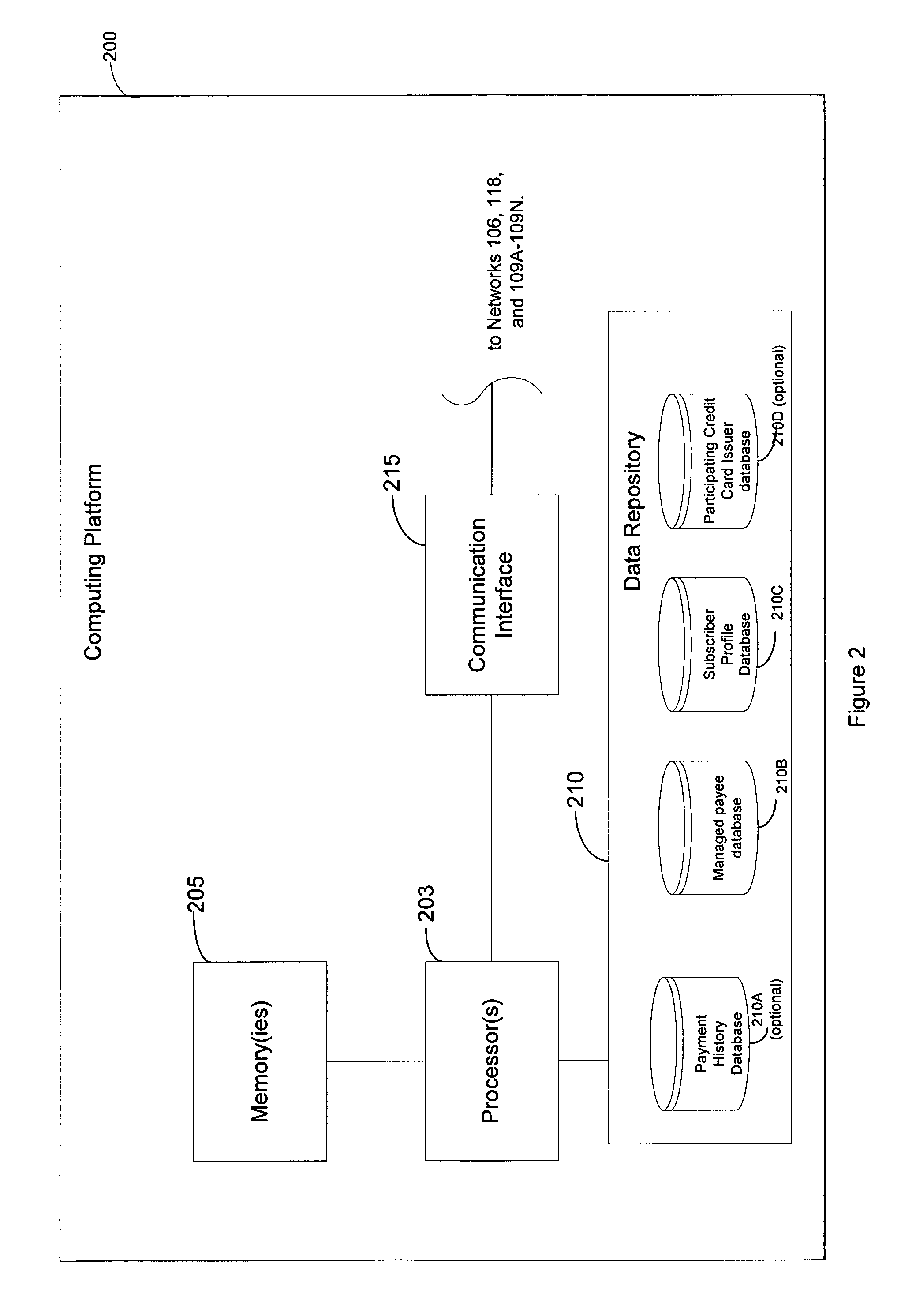

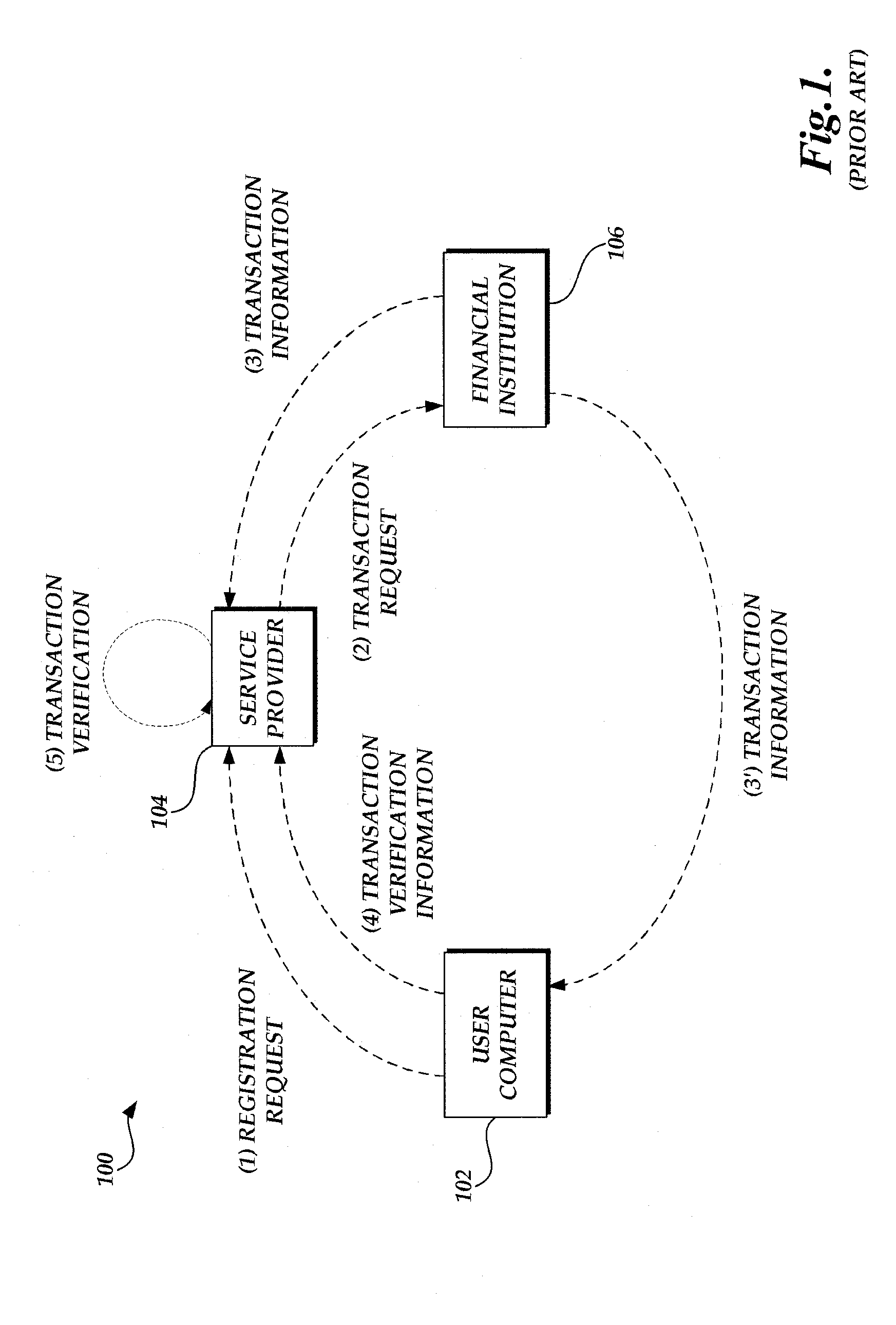

Electronic identifier payment system and methods

InactiveUS7092916B2Credit registering devices actuationAdvertisementsElectronic identificationUnique identifier

A payment service method and system involve a payment service provider, a customer / payor and a consumer provider / payee. The customer / payor enrolls in the service and is provided a unique identifier that enables the customer to conduct transactions with the payment service provider. The customer / payor interfaces with the payment service provider through various forms of communication, and can facilitate payments to the consumer providers / payees through the payment service provider while remaining anonymous.

Owner:THE WESTERN UNION CO

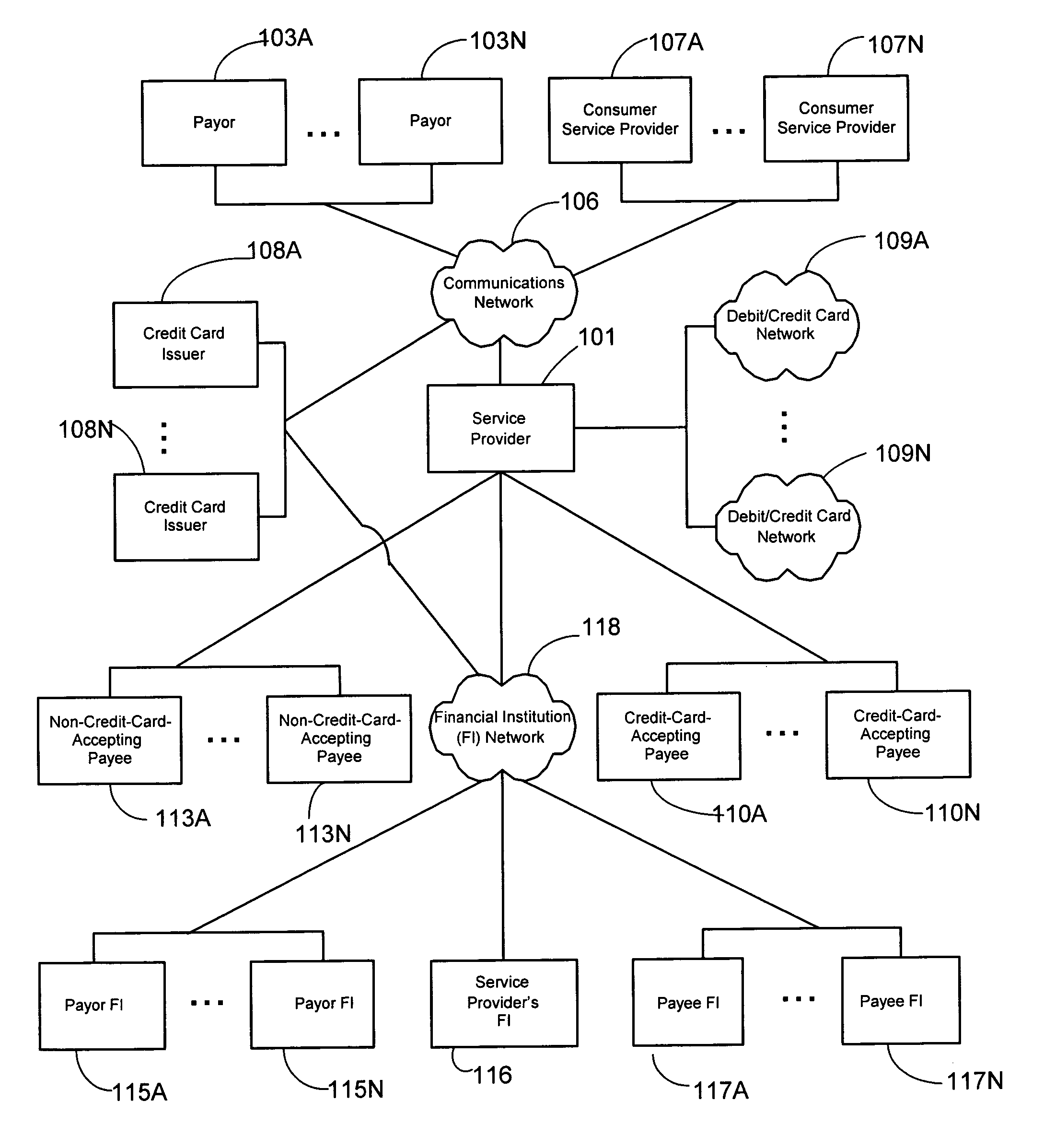

Dual mode credit card based payment technique

InactiveUS6932268B1Easy to implementEasy programmingComplete banking machinesFinanceCredit cardInternet privacy

A technique for directing a credit card based payment to a payee for a payor having a credit card issued by a credit card issuer is provided. A request for a payment service provider to make a payment to the payee on behalf of the payor is received. Payment information associated with the payment request is sent to the credit card issuer. The information is not sent via a credit card network. The credit card issuer then sends funds to the payment service provider in response to the sent payment information. These funds are not sent via a credit card network. The payment service provider delivers funds to the payee, not the credit card issuer.

Owner:CHECKFREE CORP

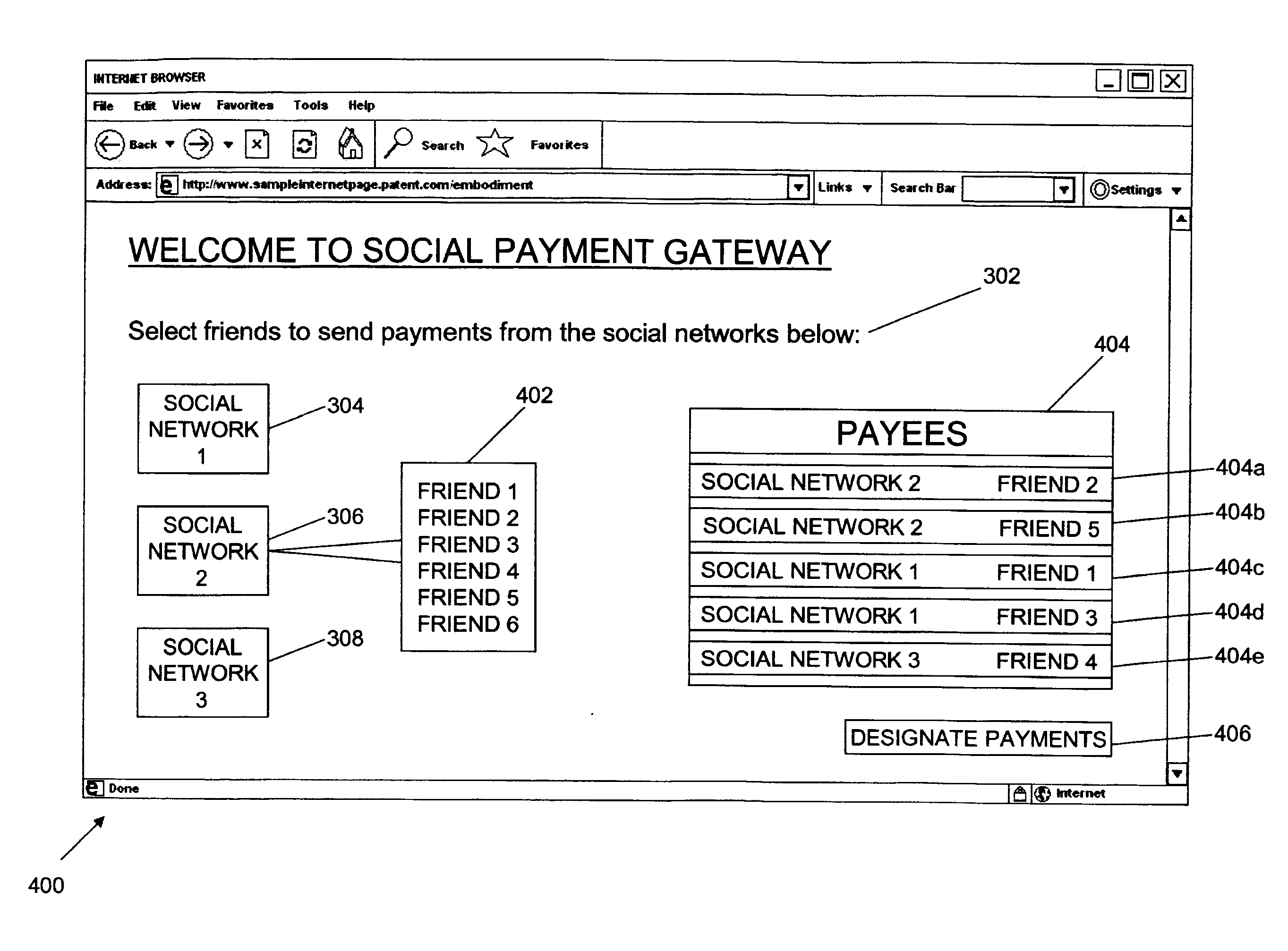

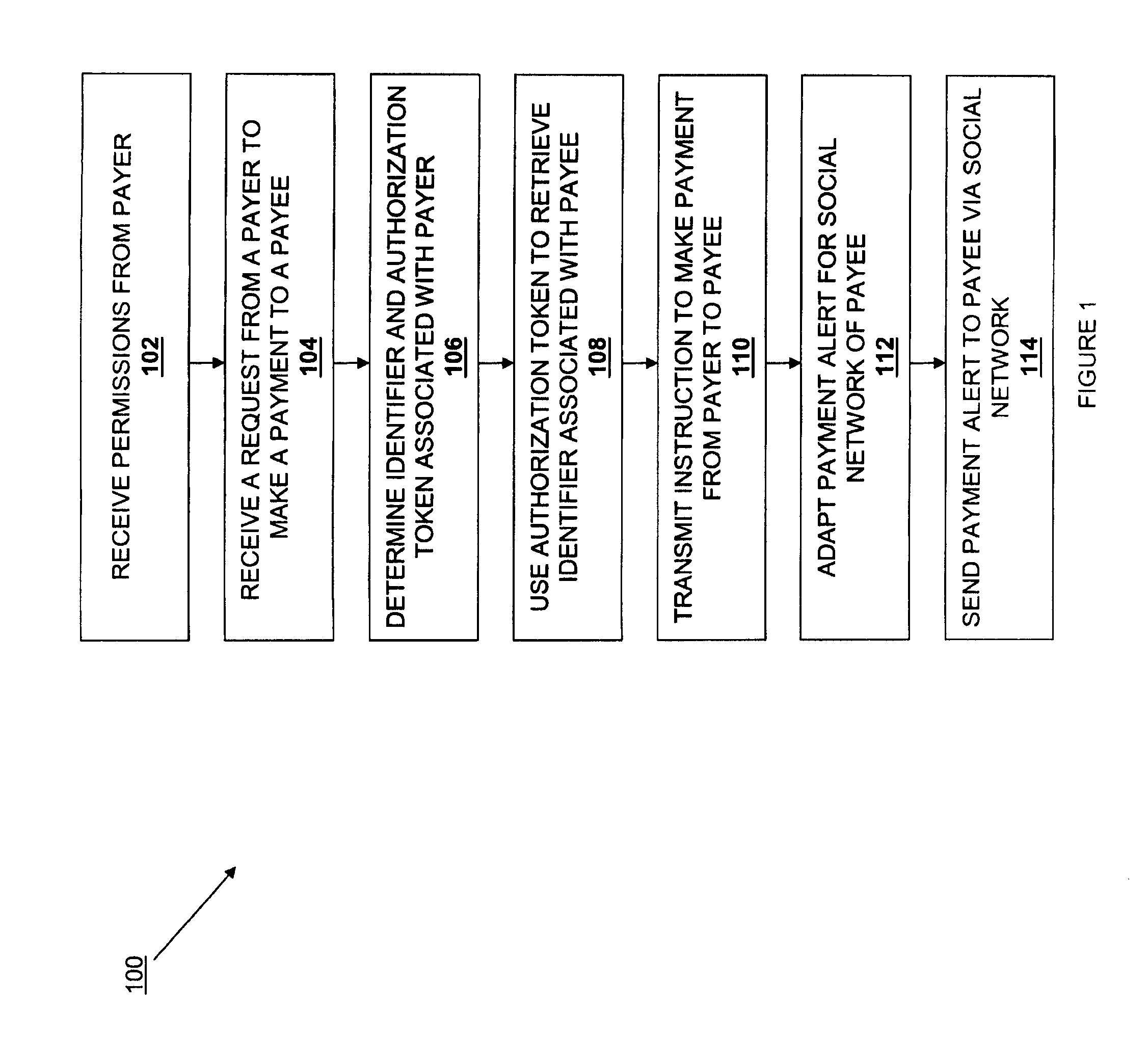

Social network payment system

A method for providing social network payments includes receiving a request to make a payment. The request is associated with a social network payer and a social network payee. It is determined that the social network payer is associated with a first payment provider identifier and an authorization token, and a second payment provider identifier for the social network payee is then retrieved using the authorization token. An instruction to make a payment from the social network payer to the social network payee is then transmitted to a payment service provider. The instruction includes a payment amount, the first payment provider identifier, and the second payment provider identifier. A payment alert is also adapted for a payee social network associated with the social network payee, and the payment alert is send to a social network provider device associated with the payee social network.

Owner:PAYPAL INC

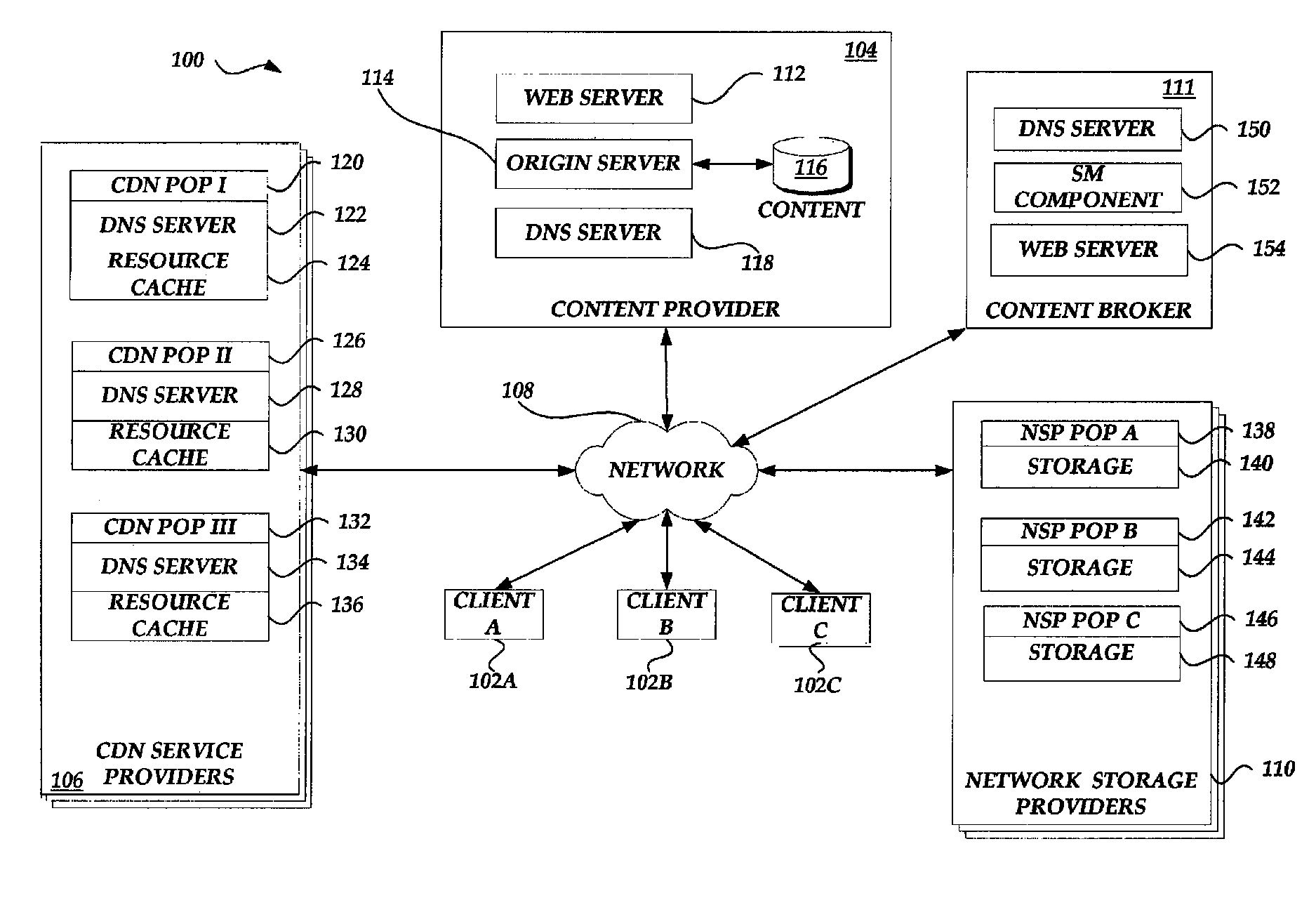

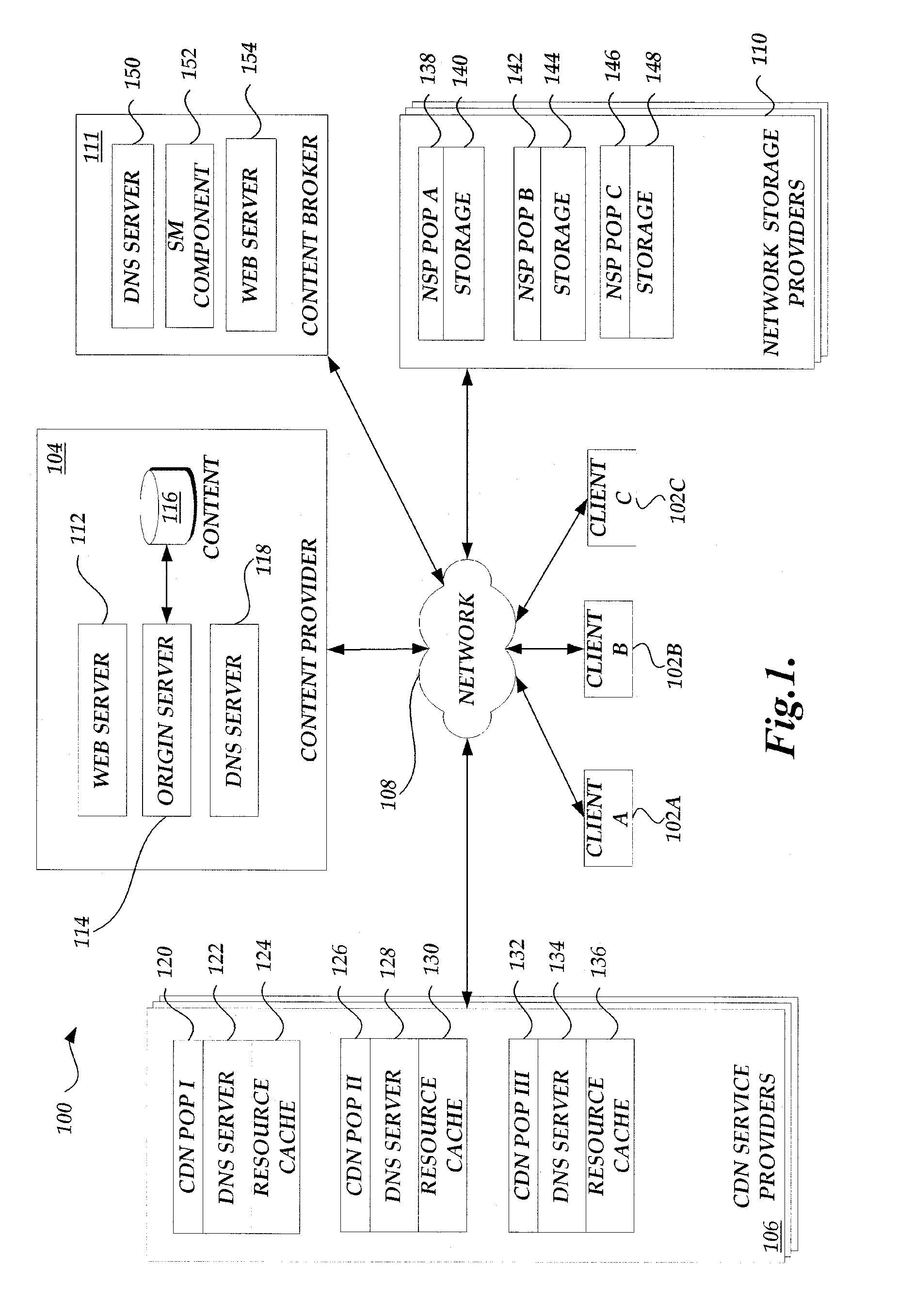

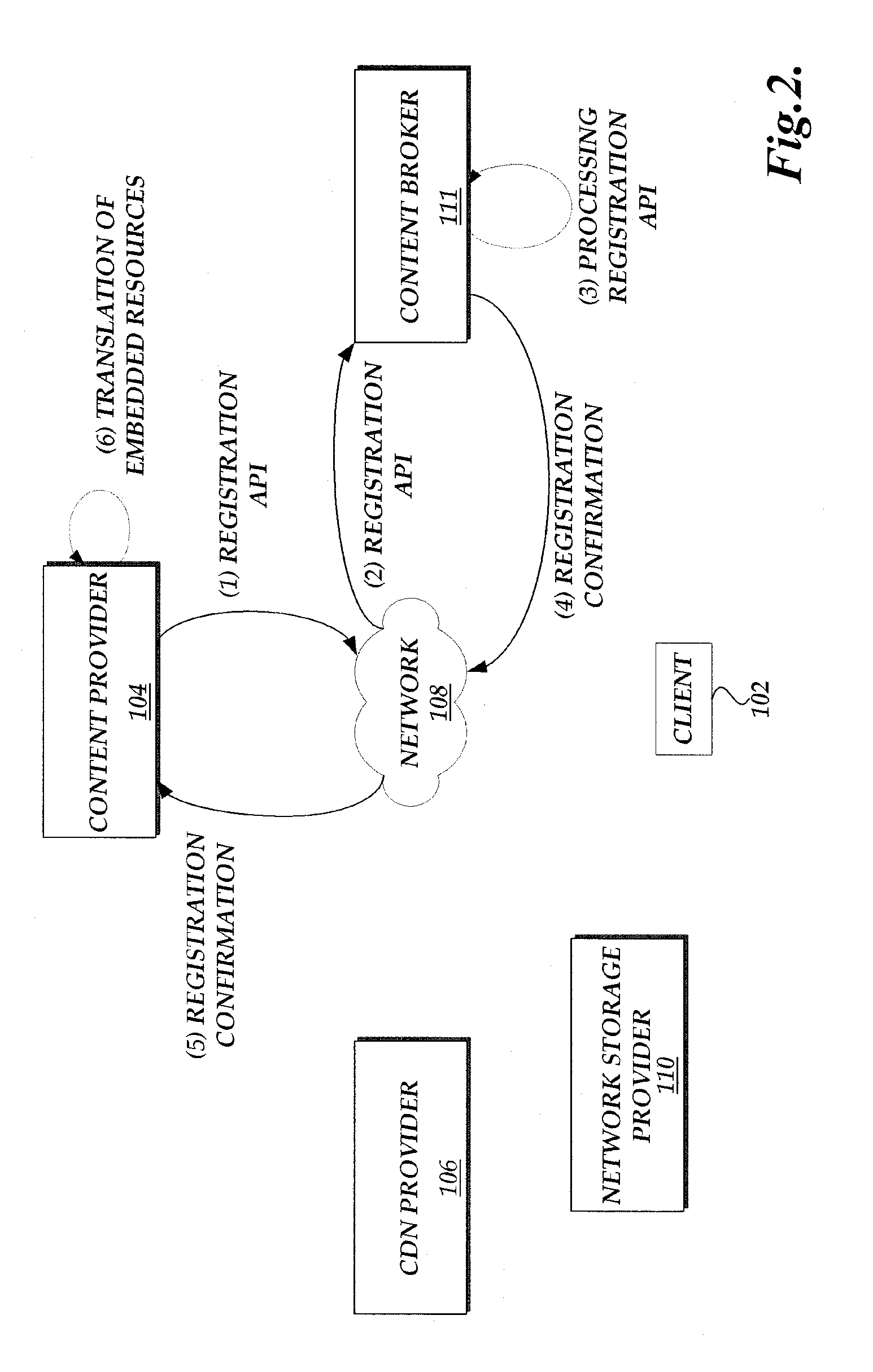

Service provider registration by a content broker

ActiveUS9444759B2Digital computer detailsSelective content distributionService provisionSelection criterion

A system, method, and computer readable medium for managing registration, by a content broker, of one or more resources with one or more service providers are provided. A content broker obtains registration information for registering the one or more resources with a service provider. The registration information may include a request to publish one or more resources to a service provider, an identification of the one or more resources, service provider selection criteria provided by the content provider or otherwise selected, and the like. The content broker transmits a service provider generation request corresponding to the registration information to the service provider. Then, the content broker manages and processes data pursuant to registration of the one or more resources with the service provider.

Owner:AMAZON TECH INC

Managing transaction accounts

Owner:AMAZON TECH INC

Mobile application, identity relationship management

ActiveUS20130086210A1Multiple digital computer combinationsDigital data authenticationApplication softwareIdentity management

Techniques for managing identities are provided. In some examples, identity management, authentication, authorization, and token exchange frameworks may be provided for use with mobile devices, mobile applications, cloud applications, and / or other web-based applications. For example a mobile client may request to perform one or more identity management operations associated with an account of a service provider. Based at least in part on the requested operation and / or the particular service provider, an application programming interface (API) may be utilized to generate and / or perform one or more instructions and / or method calls for managing identity information of the service provider.

Owner:ORACLE INT CORP

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com