Patents

Literature

583results about "Protocols using social networks" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

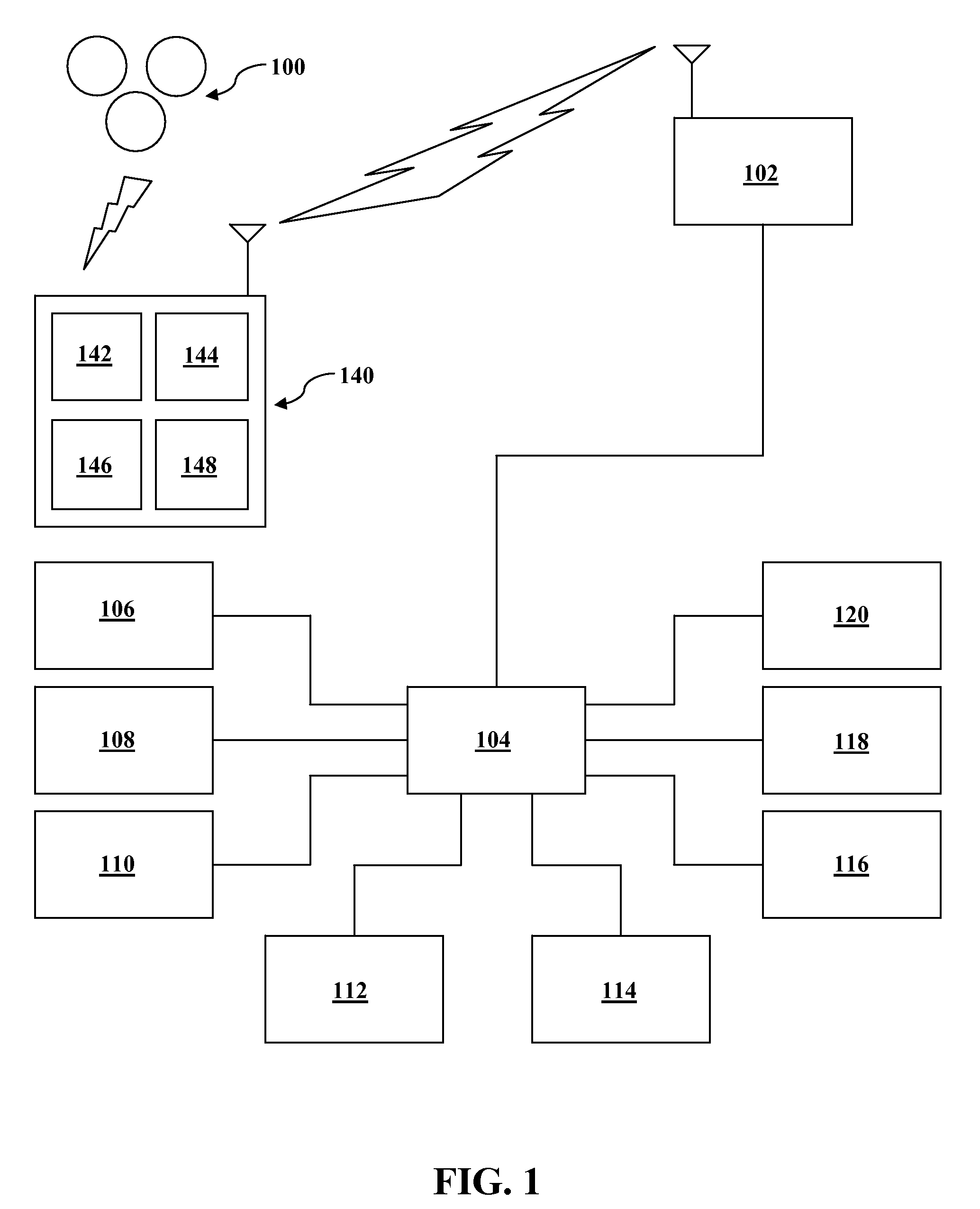

Systems and Methods to Target Predictive Location Based Content and Track Conversions

ActiveUS20080248815A1Particular environment based servicesDevices with GPS signal receiverCommunications systemMobile device

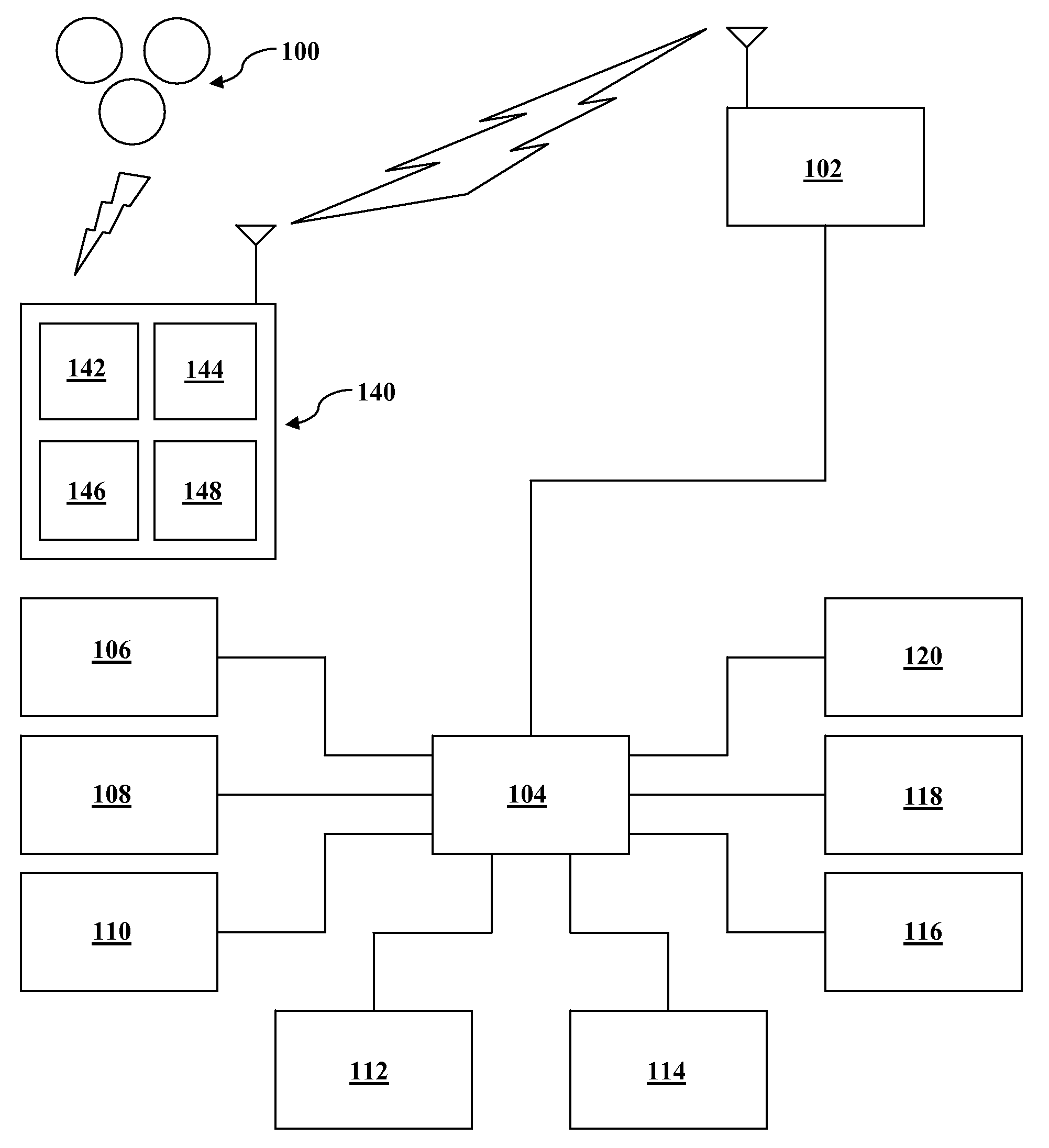

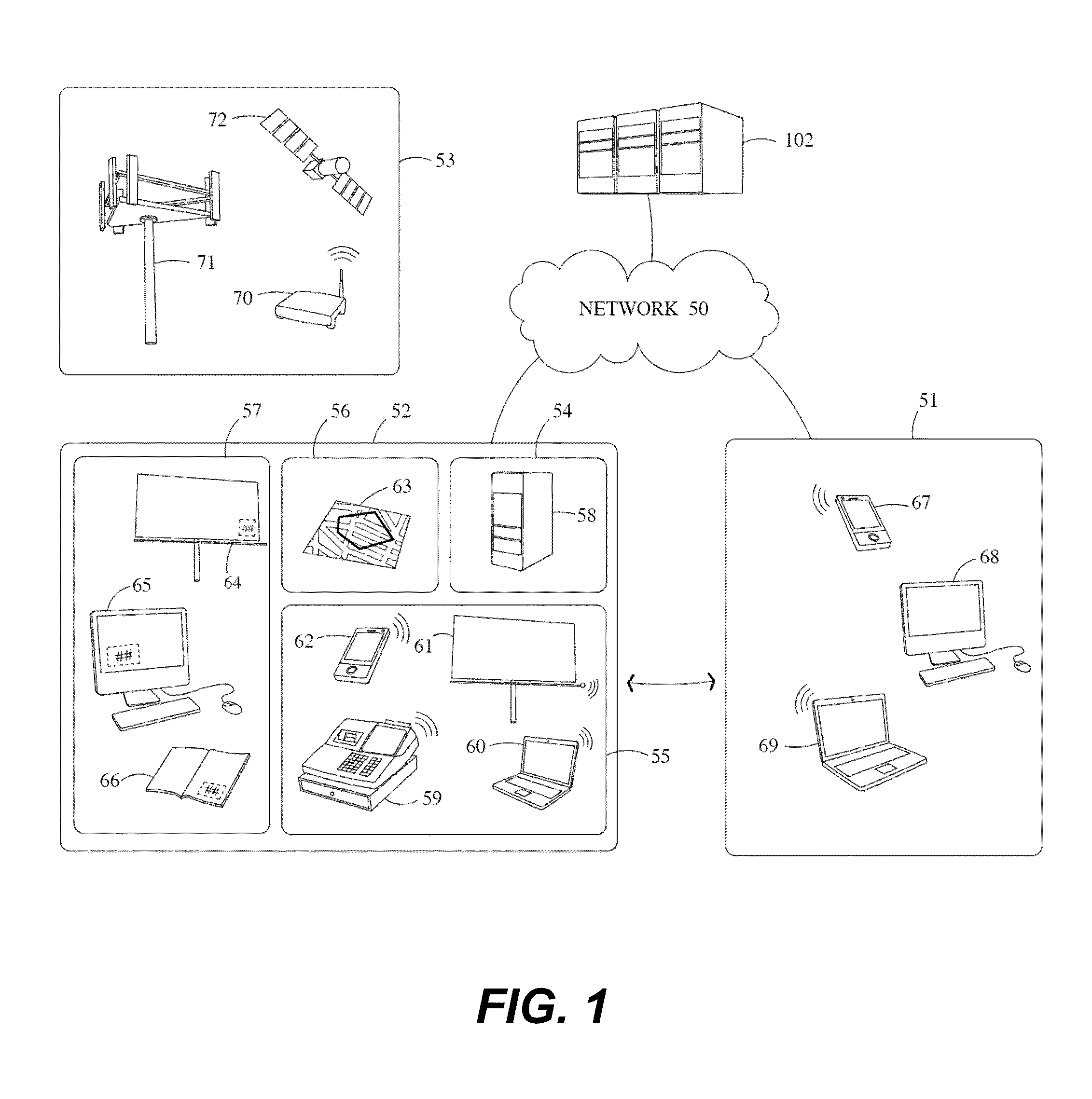

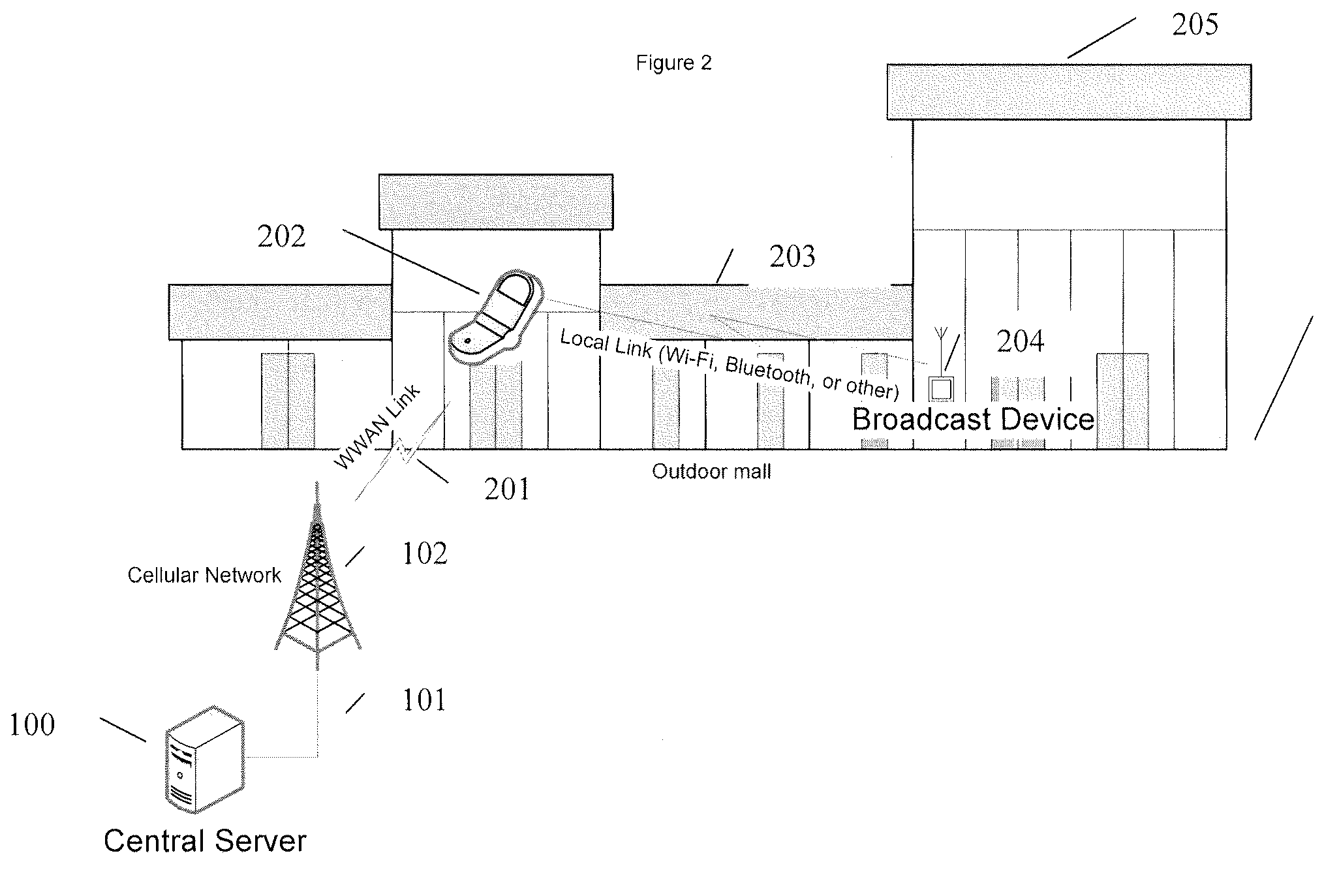

Methods and systems that record the location of a user and transmit targeted content to a user based upon their current and past location information. A network is configured to include a server programmed with a database of targeted content, a database of location information, a database of user information, a database searching algorithm, and a wireless communication system capable of communicating with the user's mobile device. The location of the mobile device is ascertained and recorded. The location information is analyzed to determine the routes taken by the user, businesses visited by the user, and other behaviors of the user. Targeted content is sent to the mobile device of the user and whether the user visits the physical locations associated with the targeted content is monitored. Payment systems, phone exchange systems, and other features may also be integrated to provide detailed conversion tracking to producers of targeted content and business owners.

Owner:META PLATFORMS INC

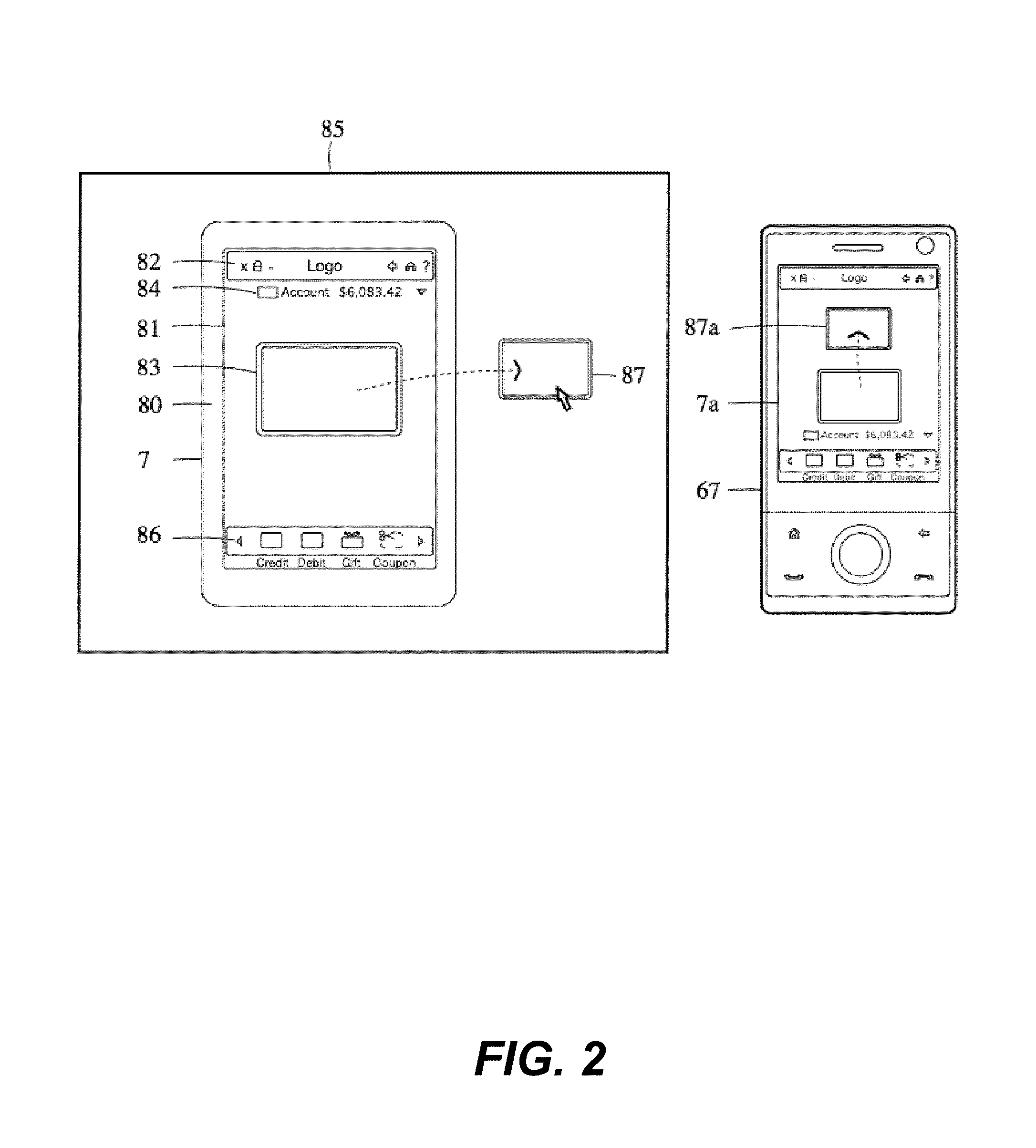

Dispensing digital objects to an electronic wallet

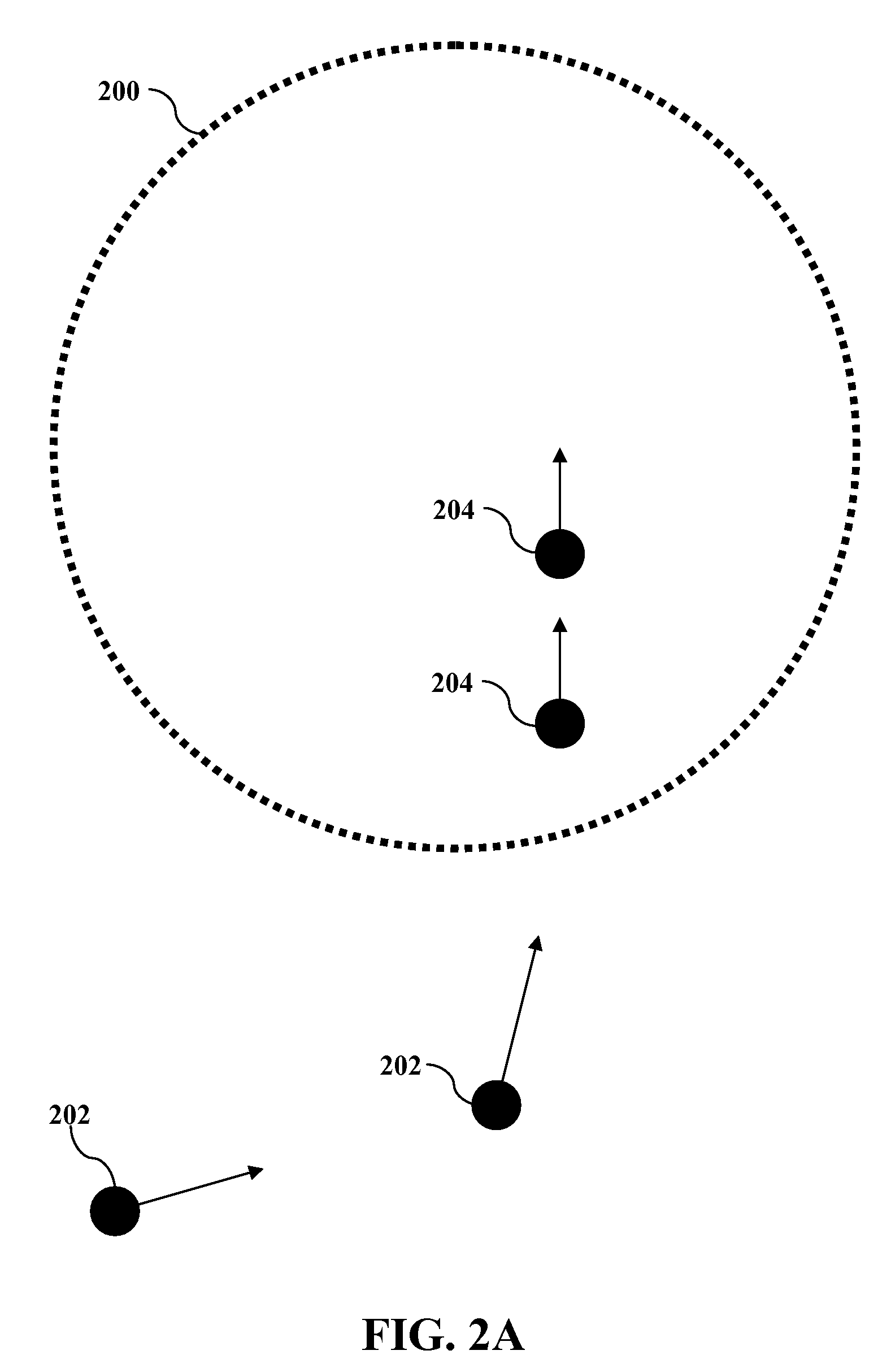

A configuration system and method is disclosed that includes a unified and integrated configuration that is composed of a payment system, an advertising system, and an identity management system such that the unified system has all of the benefits of the individual systems as well as several additional synergistic benefits. Also described are specific configurations including the system's access point architecture, visual wallet simulator user interface, security architecture, coupon handling as well as the system's structure and means for delivering them as targeted advertising, business card handling, membership card handling for the purposes of login management, receipt handling, and the editors and grammars provided for customizing the different types of objects in the system as well as the creation of new custom objects with custom behaviors. The configurations are operable on-line as well as through physical presence transactions.

Owner:GOOGLE LLC

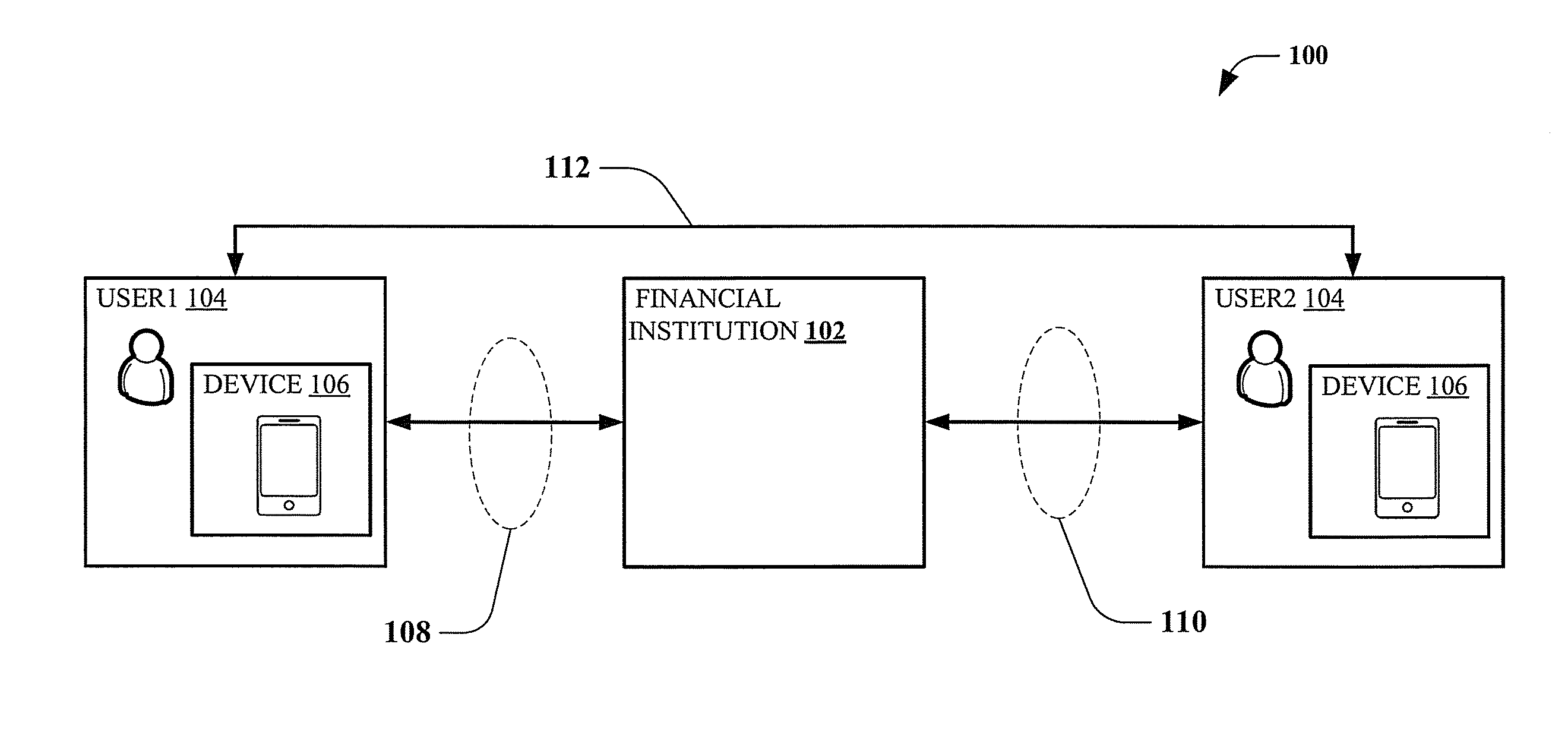

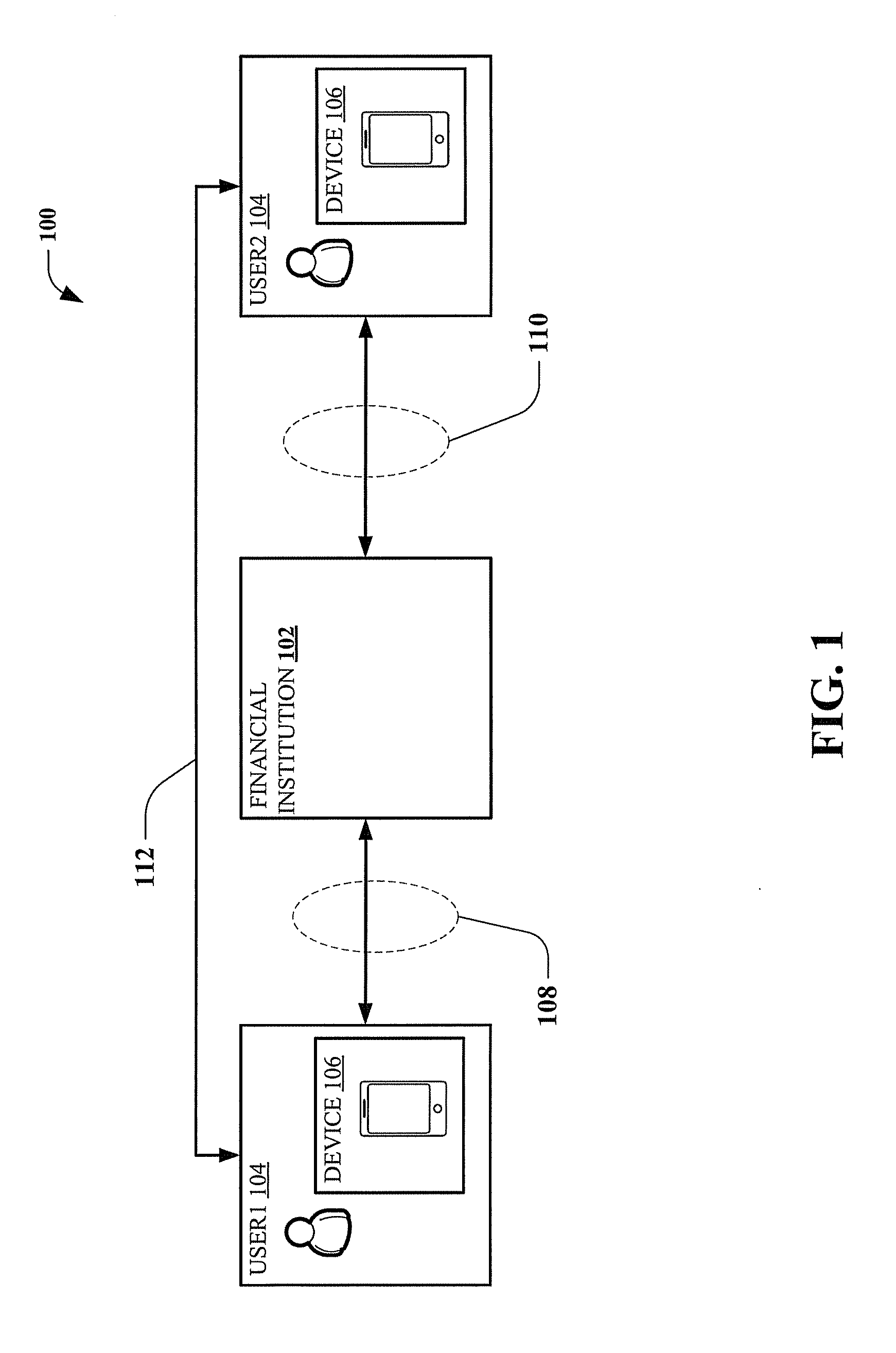

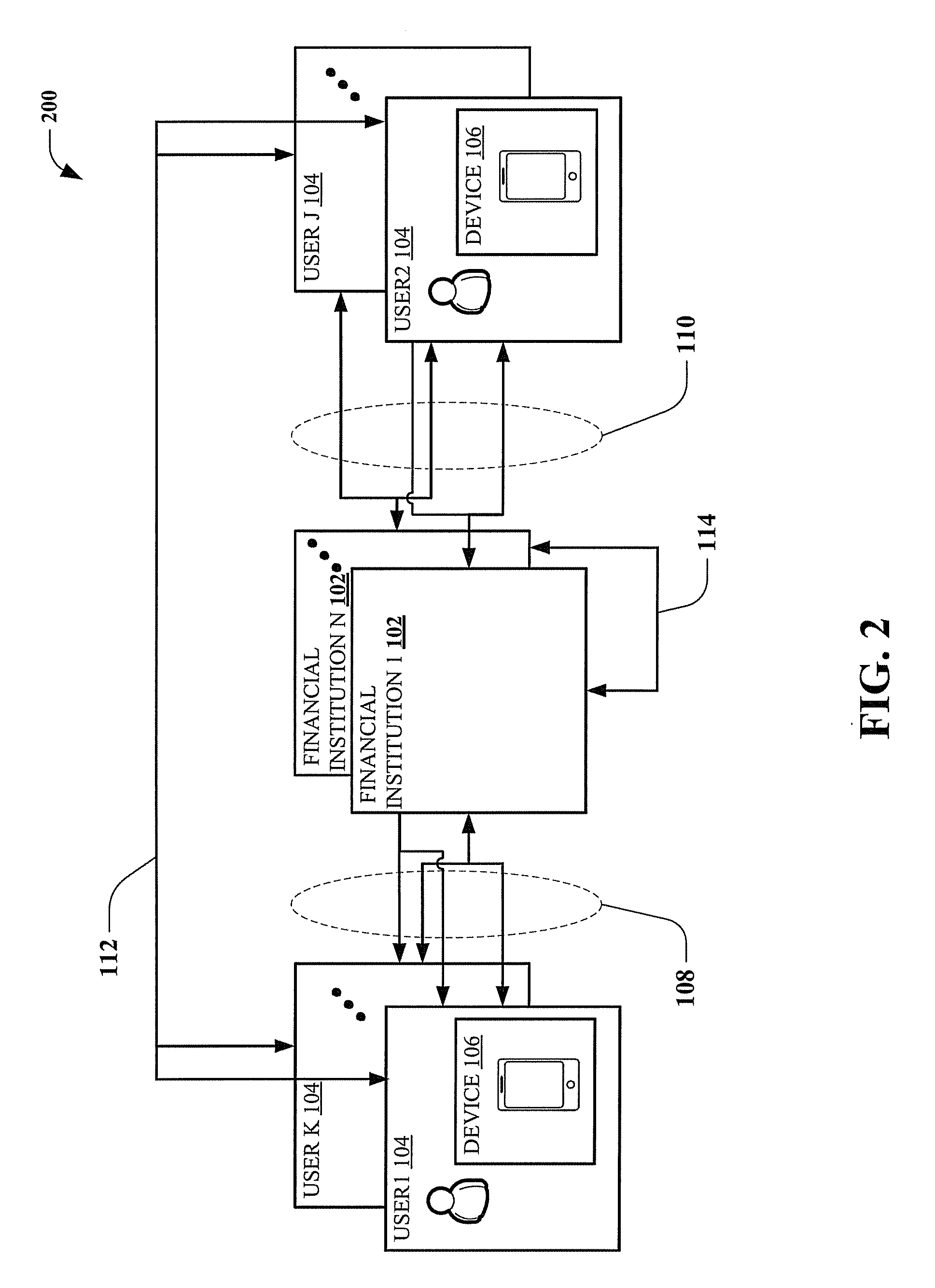

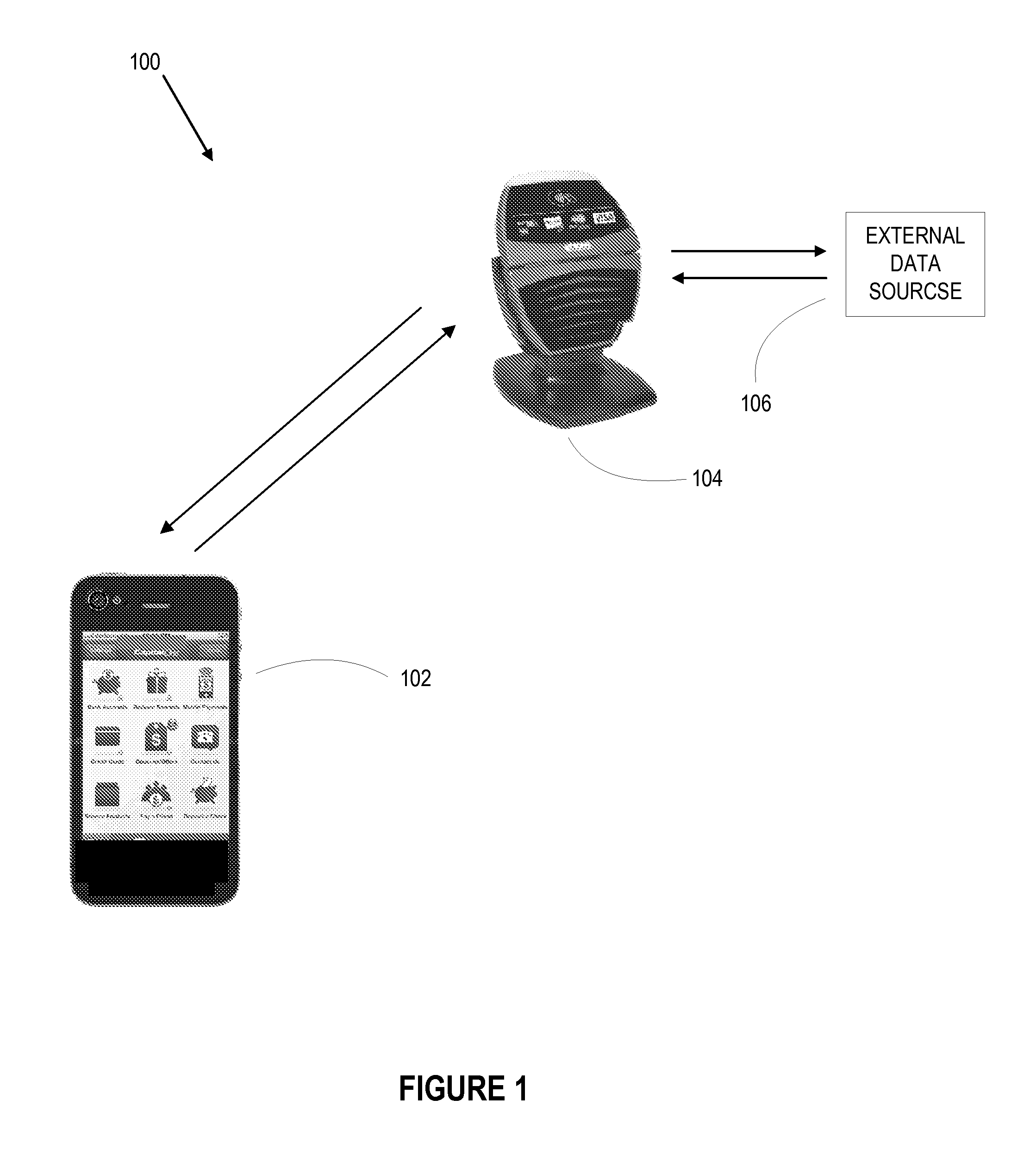

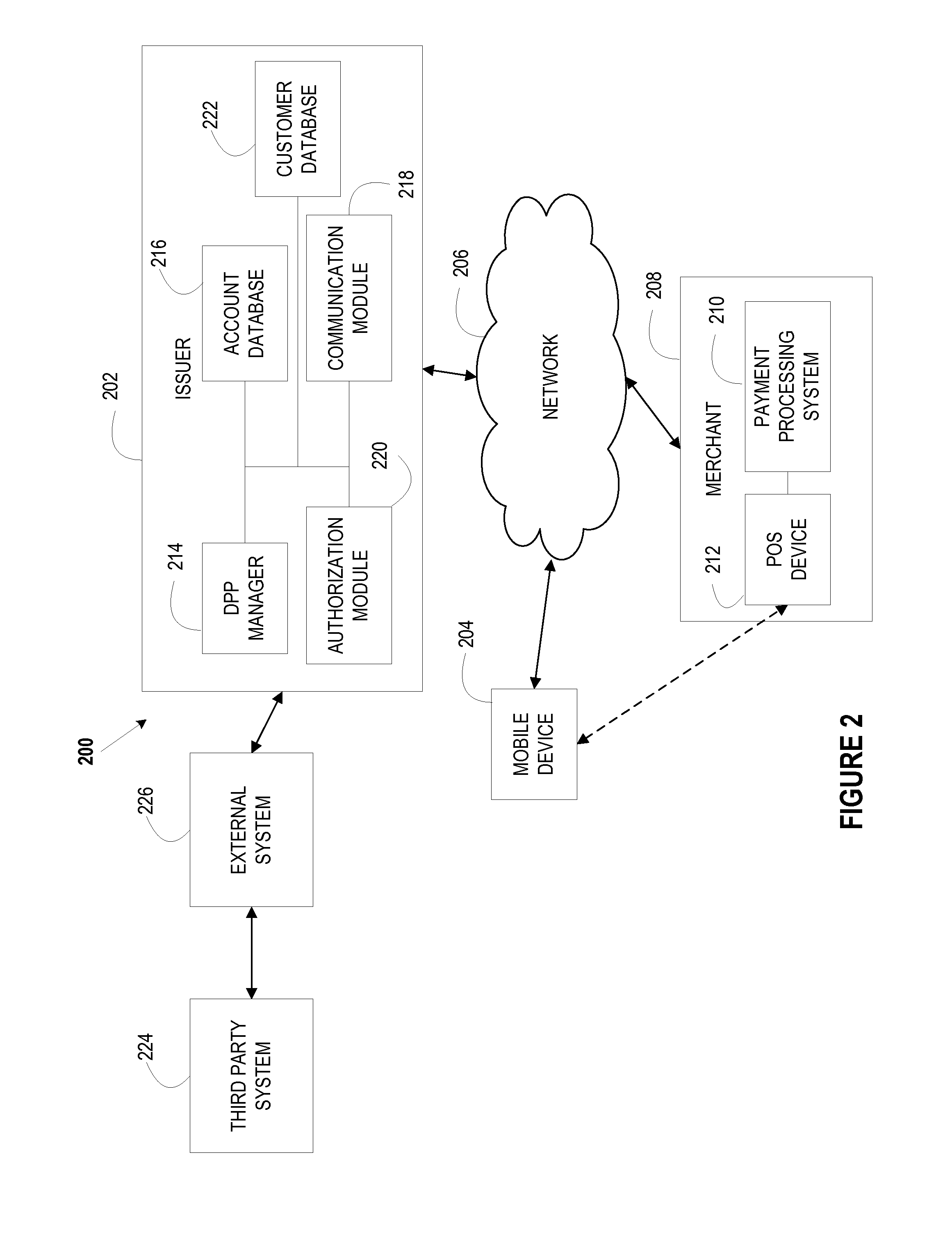

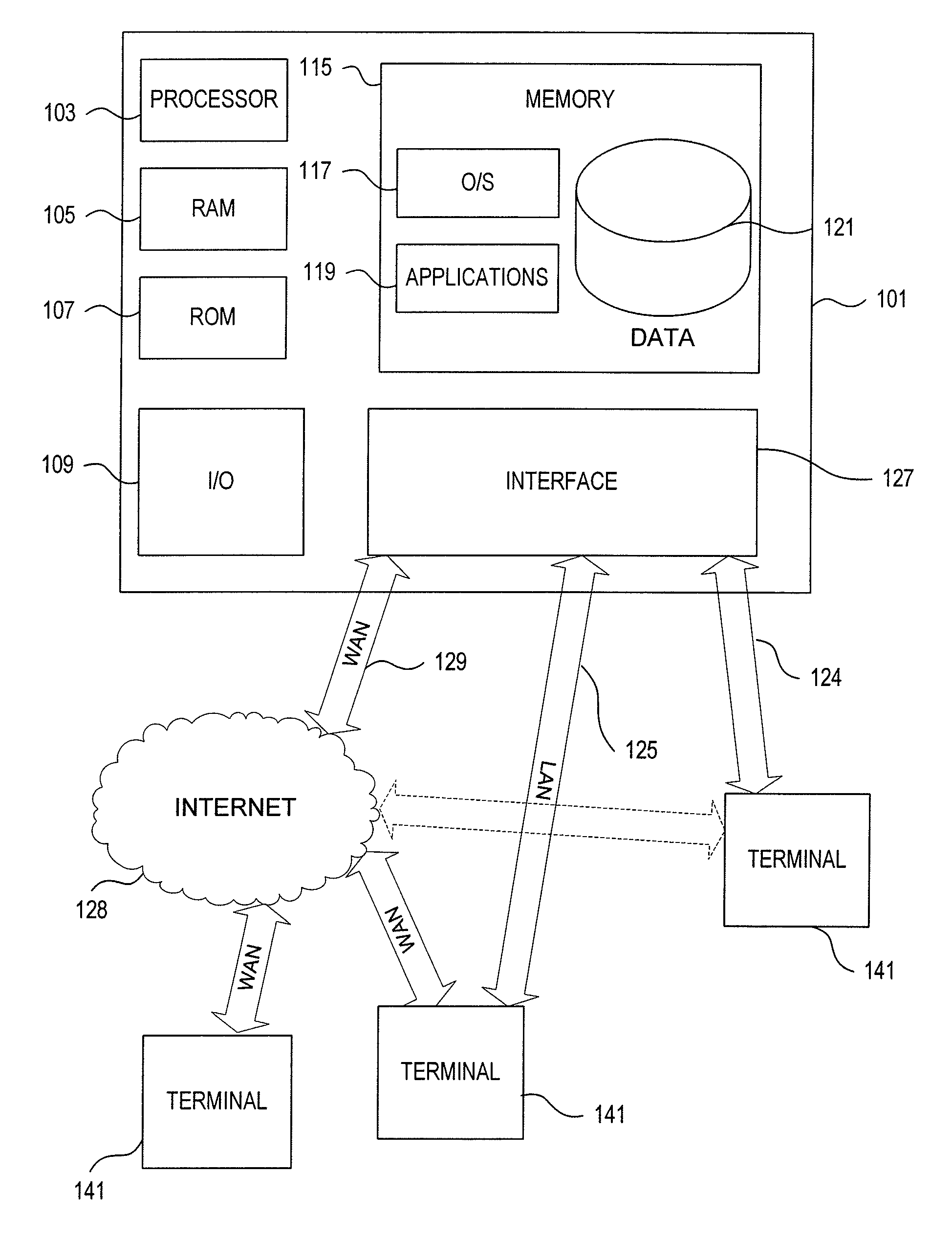

Electronic payment systems and supporting methods and devices

ActiveUS20130060690A1Efficient transferFinanceProtocols using social networksSystems designSubject matter

Electronic payment systems and supporting methods and devices are described. For instance, the disclosed subject matter describes aggregated transactional account functionality configured to receive electronic financial transactions associated with one or more of a set of electronic identifying information such as phone ID, email, instant message, etc. for a user and related functionality. The disclosed details enable various refinements and modifications according to system design and tradeoff considerations.

Owner:RPX CORP

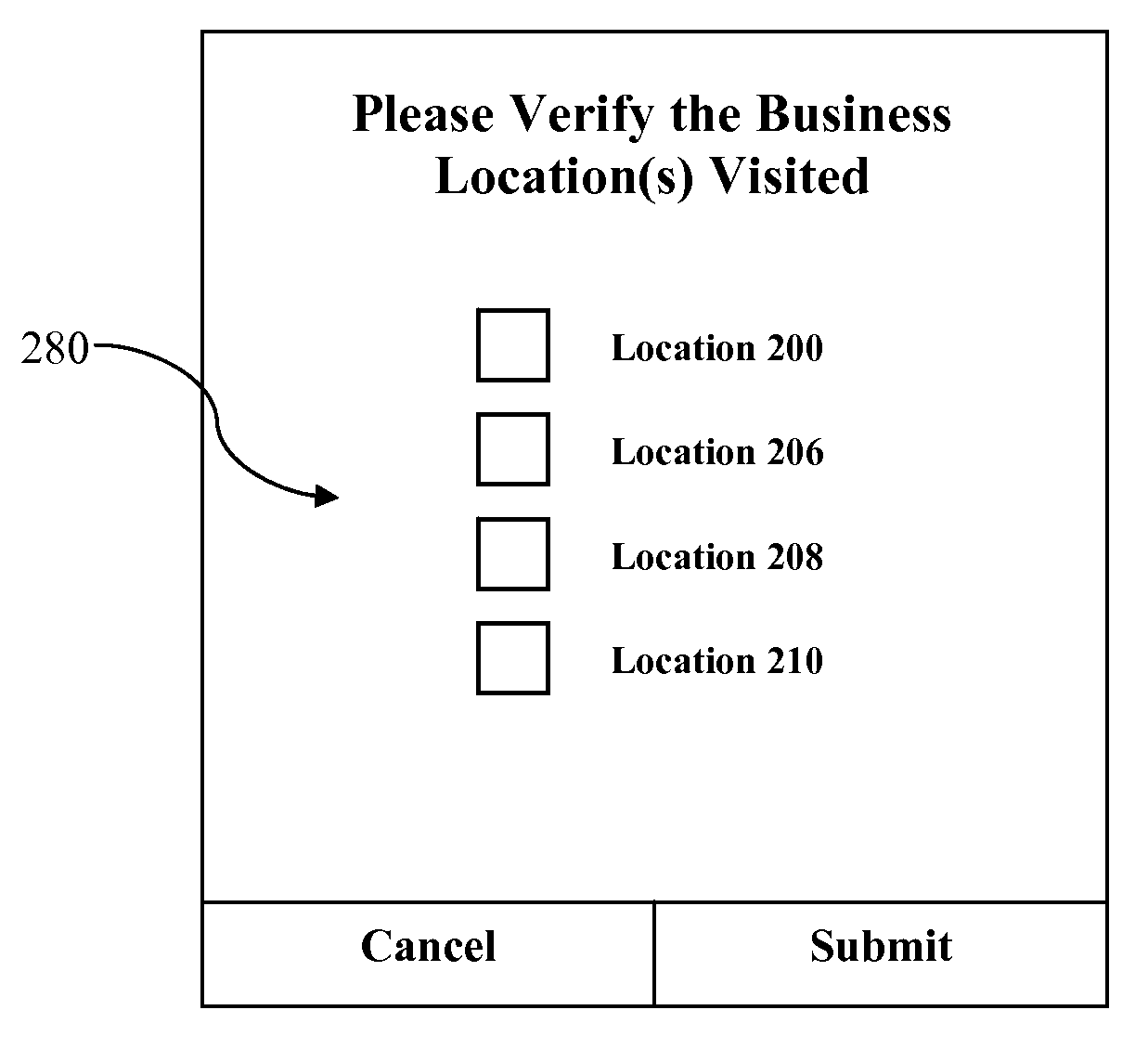

Systems and methods to determine the name of a location visited by a user of a wireless device

ActiveUS8229458B2Particular environment based servicesDevices with GPS signal receiverCommunications systemMobile device

Methods and systems that record the location of a user and transmit targeted content to a user based upon their current and past location information. A network is configured to include a server programmed with a database of targeted content, a database of location information, a database of user information, a database searching algorithm, and a wireless communication system capable of communicating with the user's mobile device. The location of the mobile device is ascertained and recorded. The location information is analyzed to determine the routes taken by the user, businesses visited by the user, and other behaviors of the user. Targeted content is sent to the mobile device of the user and whether the user visits the physical locations associated with the targeted content is monitored. Payment systems, phone exchange systems, and other features may also be integrated to provide detailed conversion tracking to producers of targeted content and business owners.

Owner:META PLATFORMS INC

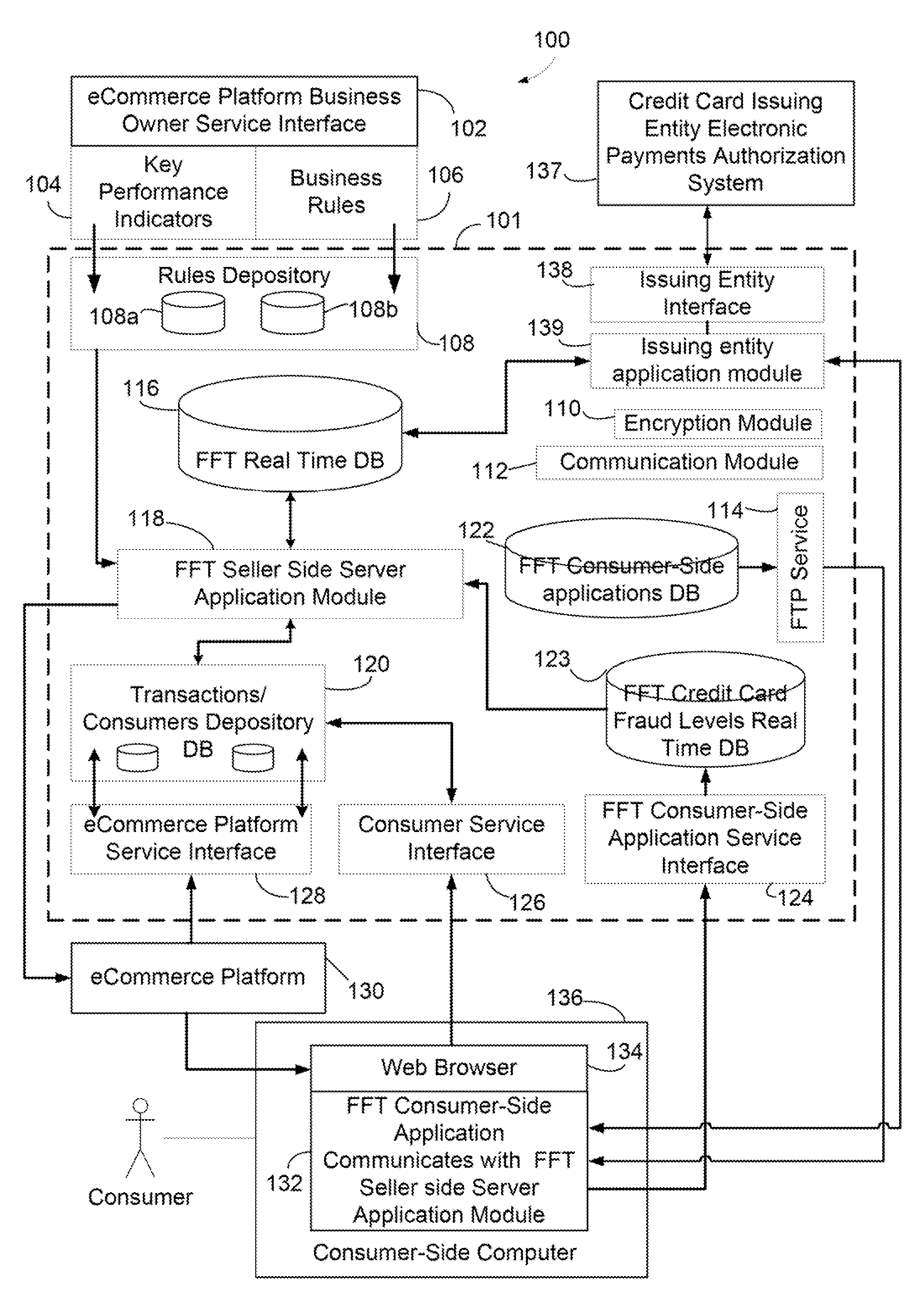

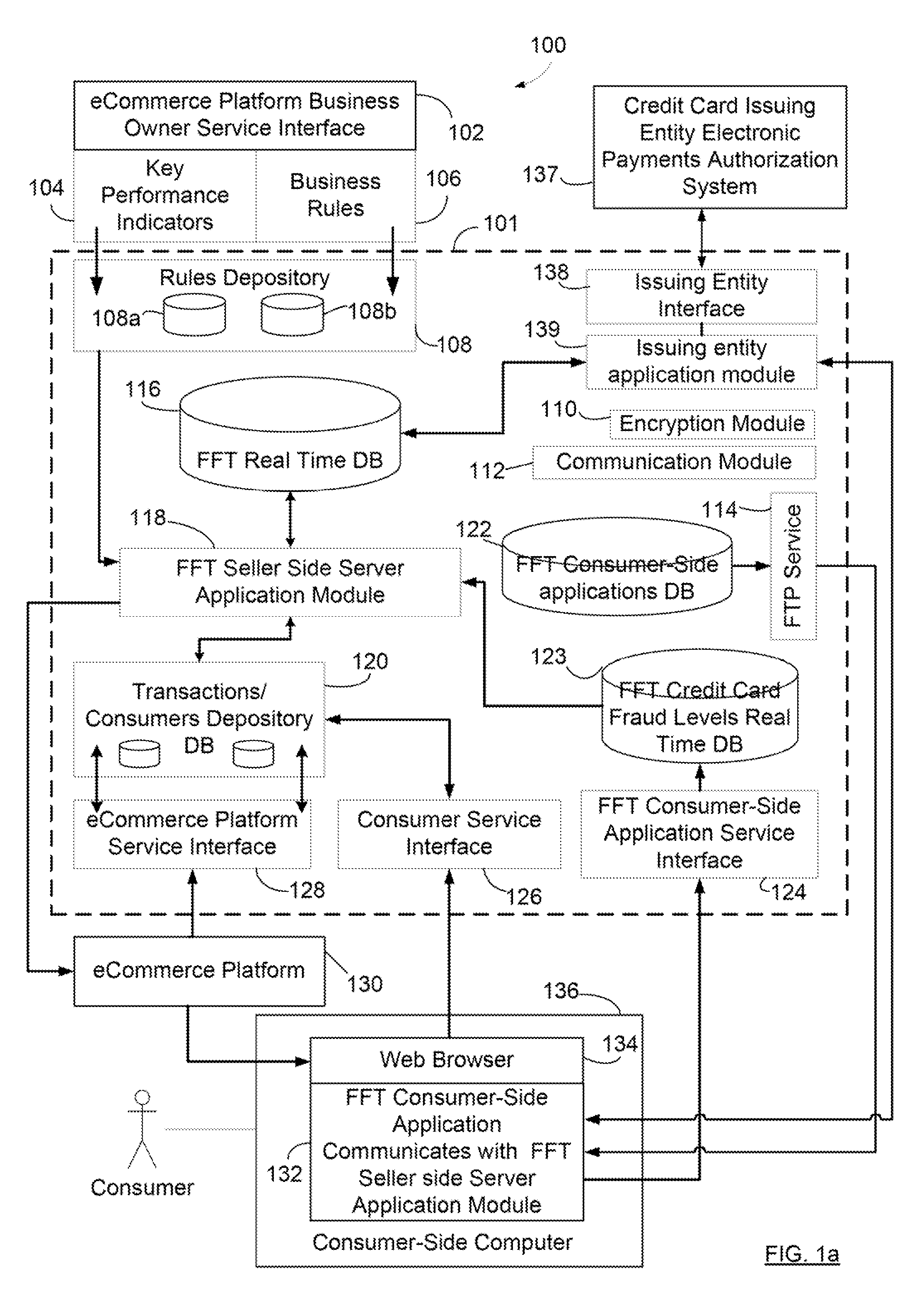

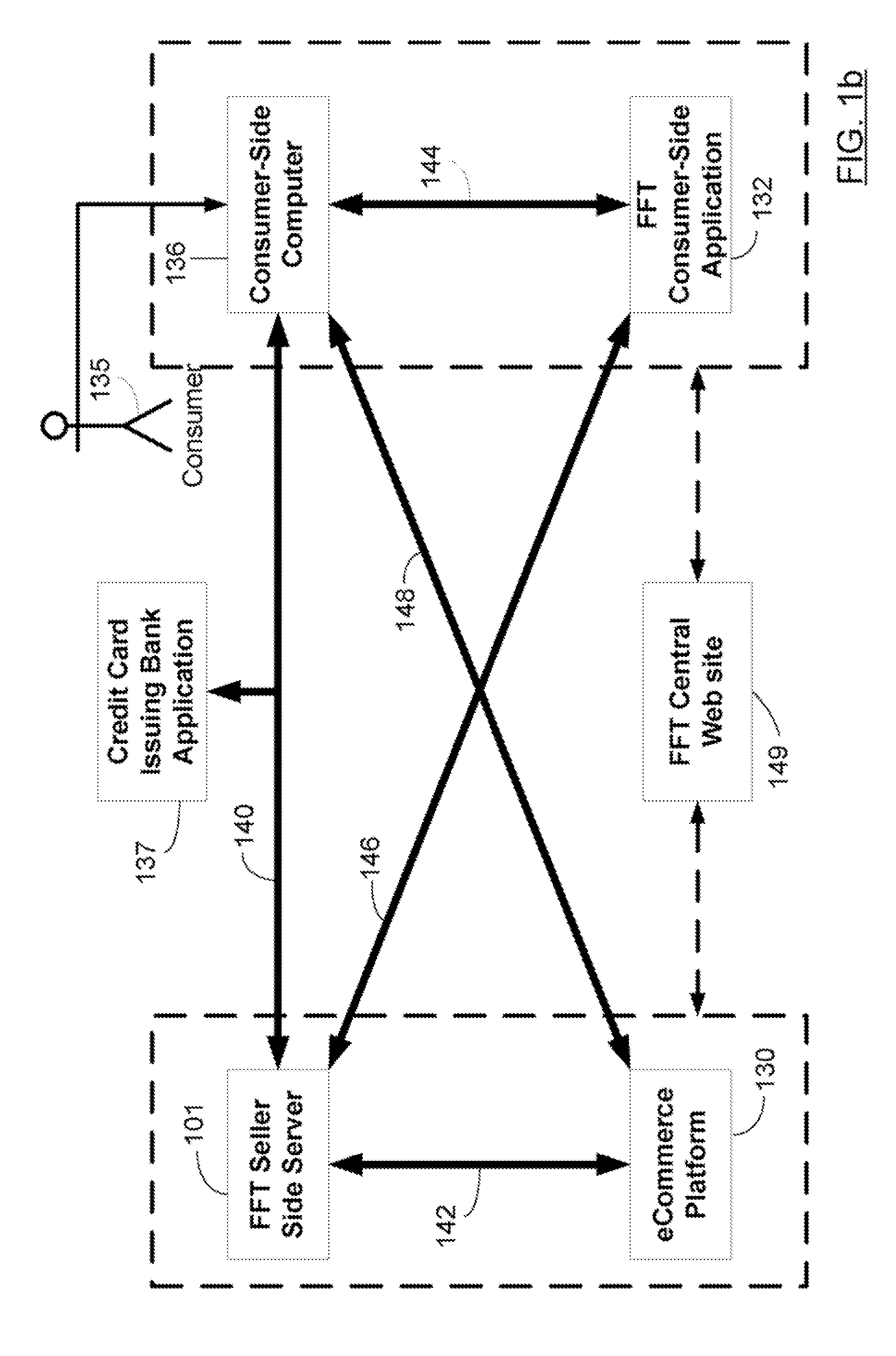

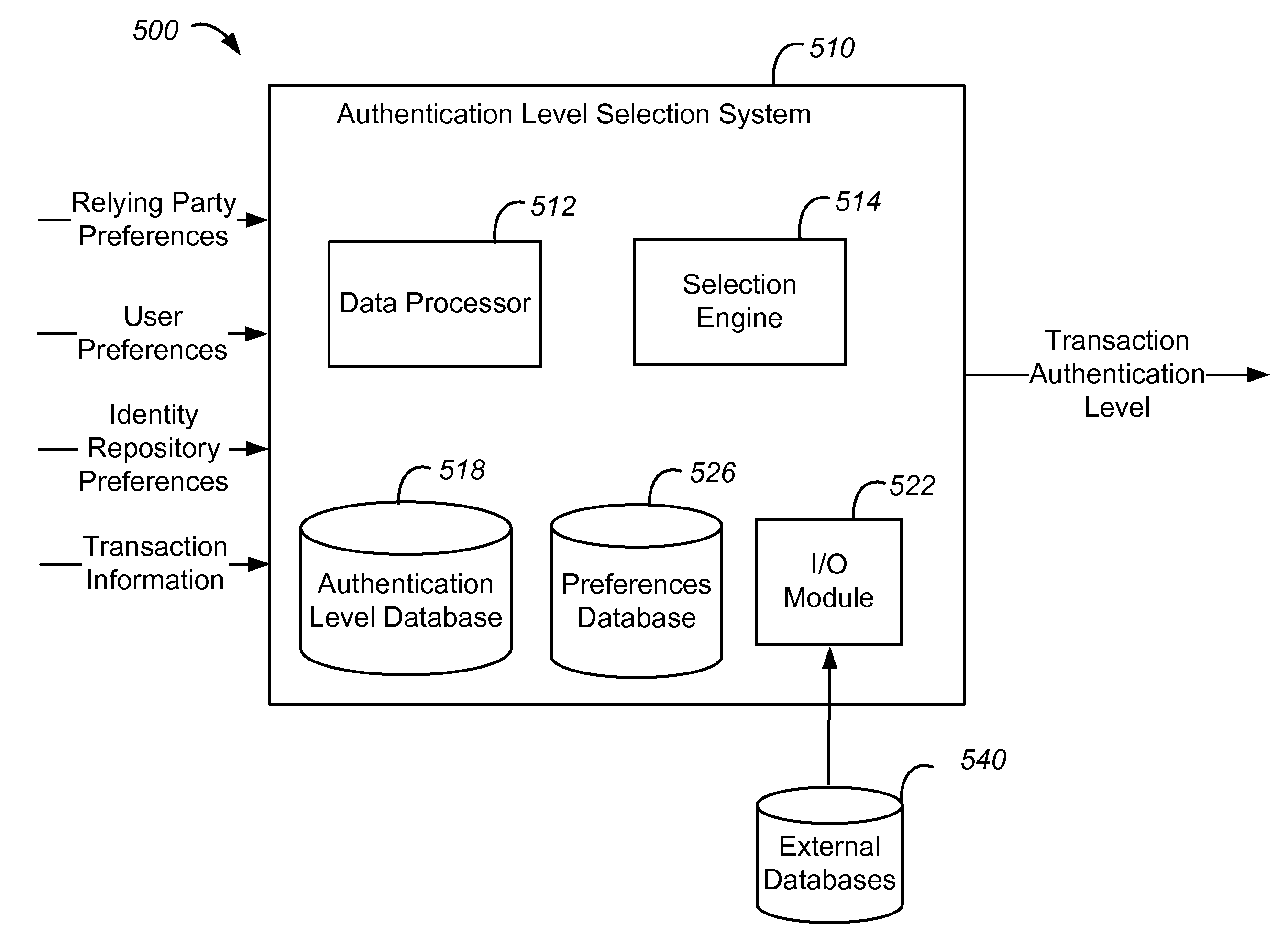

Systems and Methods for Automatic and Transparent Client Authentication and Online Transaction Verification

Systems and methods are described for providing fraud deterrents, detection and prevention during e-commerce, e-transactions, digital rights management and access control. Fraud deterrent levels may be automatically selected by a requesting transaction approval entity server (and can be related to level of risk, or security, related to fraud) or may be selected by a consumer. These deterrent levels can determine the manner in which the transaction occurs as well as the types of information that must be provided and validated for successful approval of the transaction. The client can associate their credit card with a specific device, an e-identity, such as an instant messaging identity, and the e-identity is contacted as a part of finalizing a payment transaction so that a client response of ‘approve’ or ‘reject’ can be obtained. The anti-fraud technology also provides for management and storage of historical transaction information. Entity-to-client communication occurs according to merchant permission parameters which are defined by the client and which enable messages sent by the entity to be automatically allowed, rejected, and managed in other ways as well.

Owner:JOHN MICHAEL SASHA

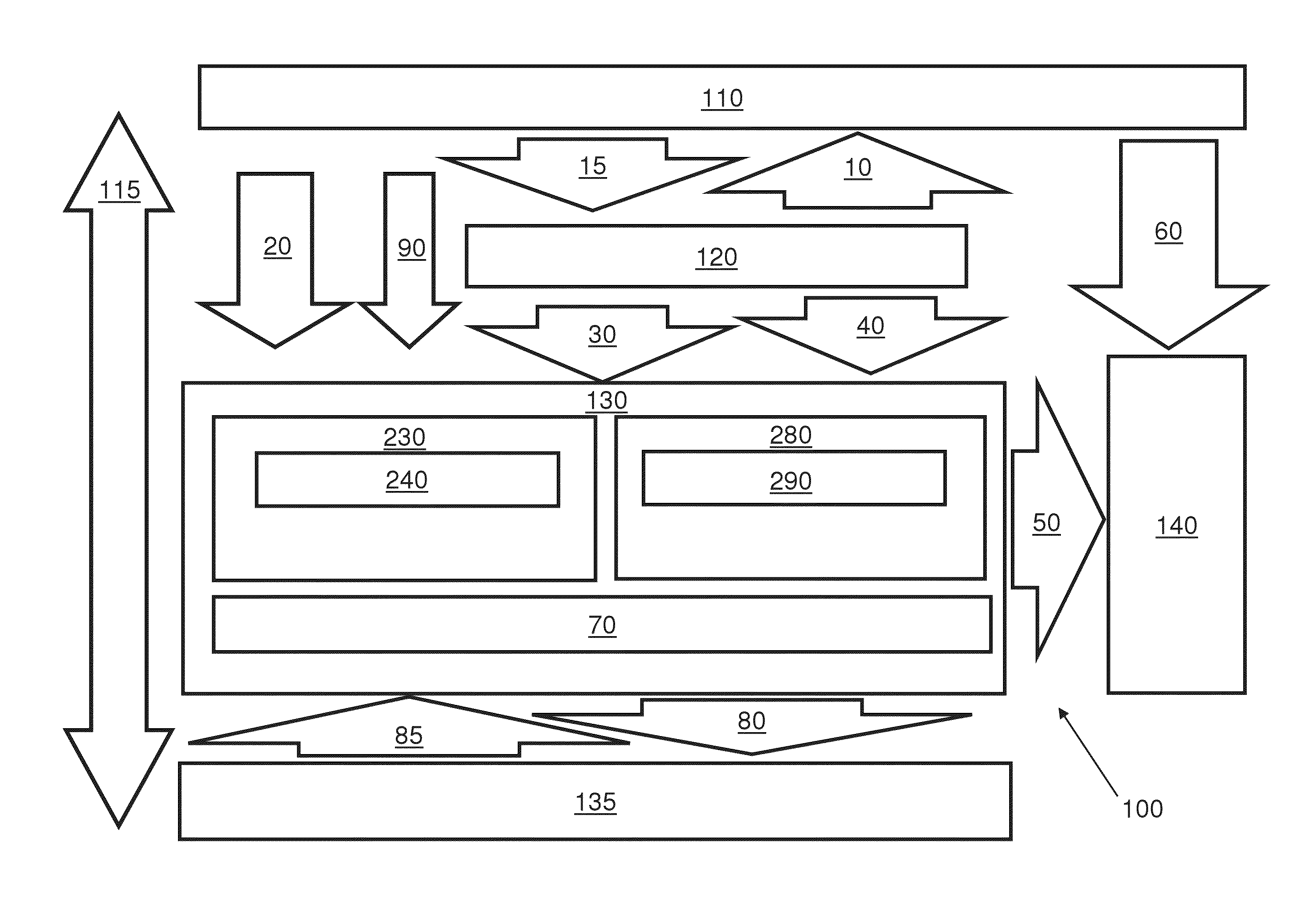

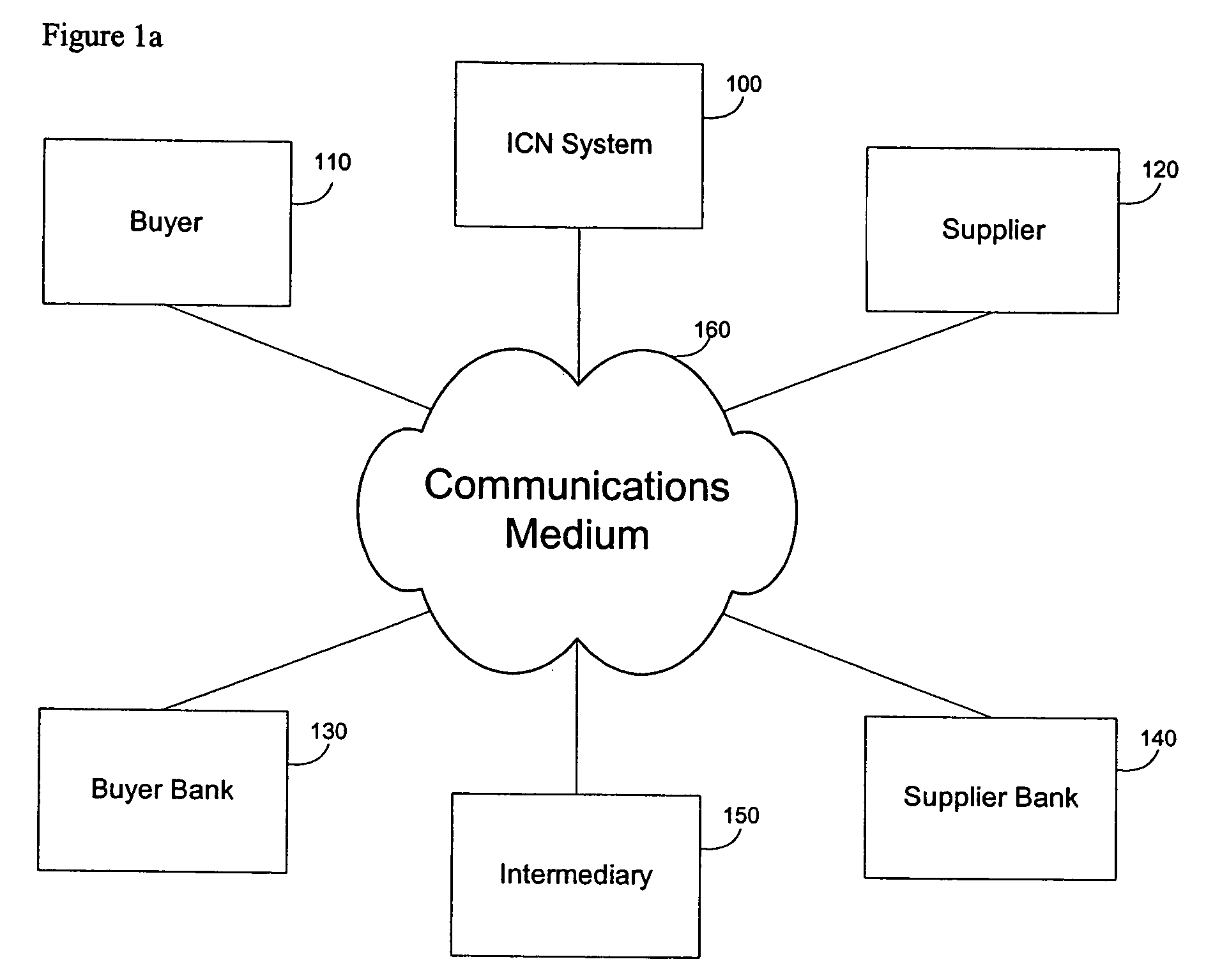

Authentication & authorization of transactions using an external alias

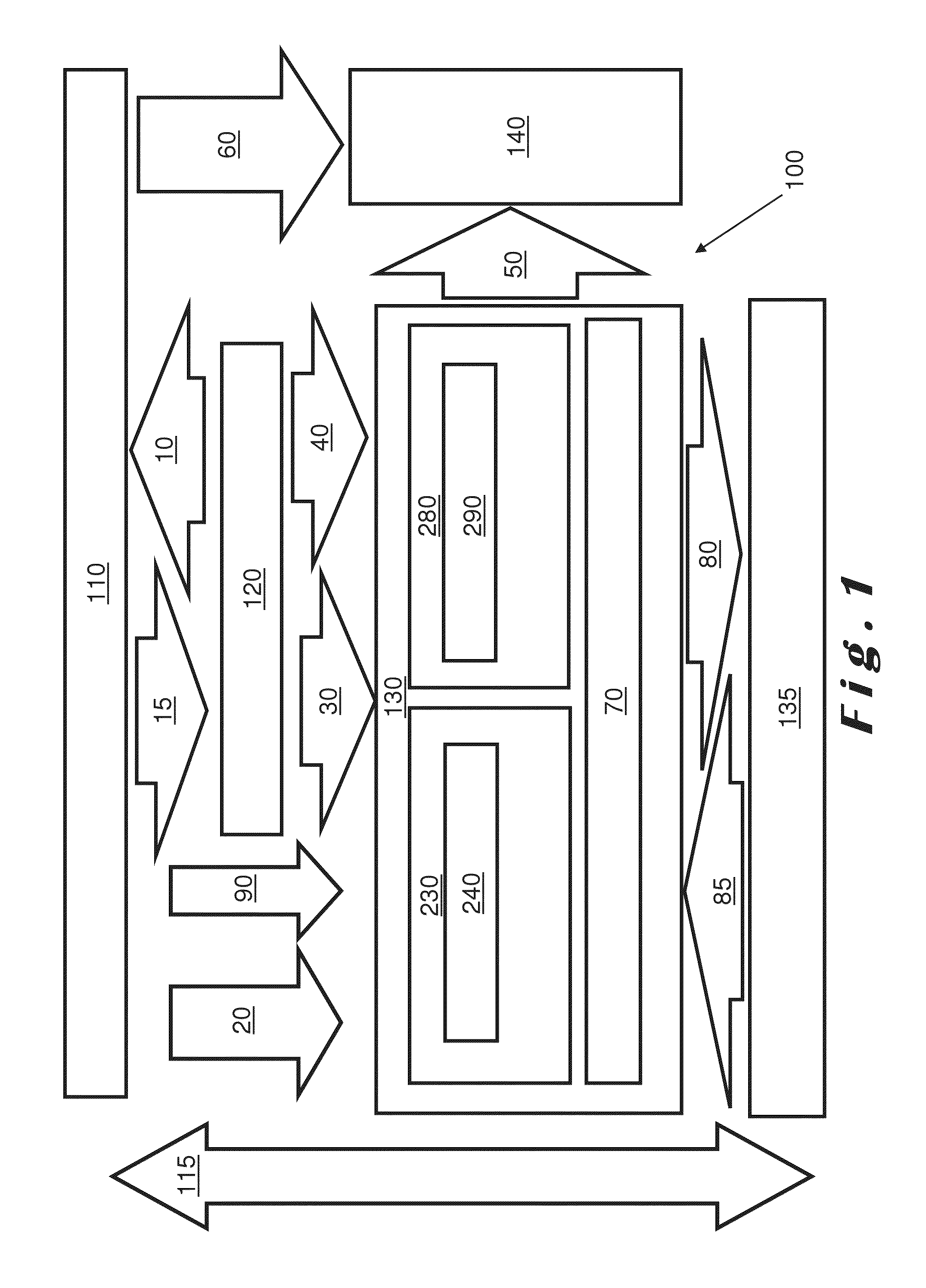

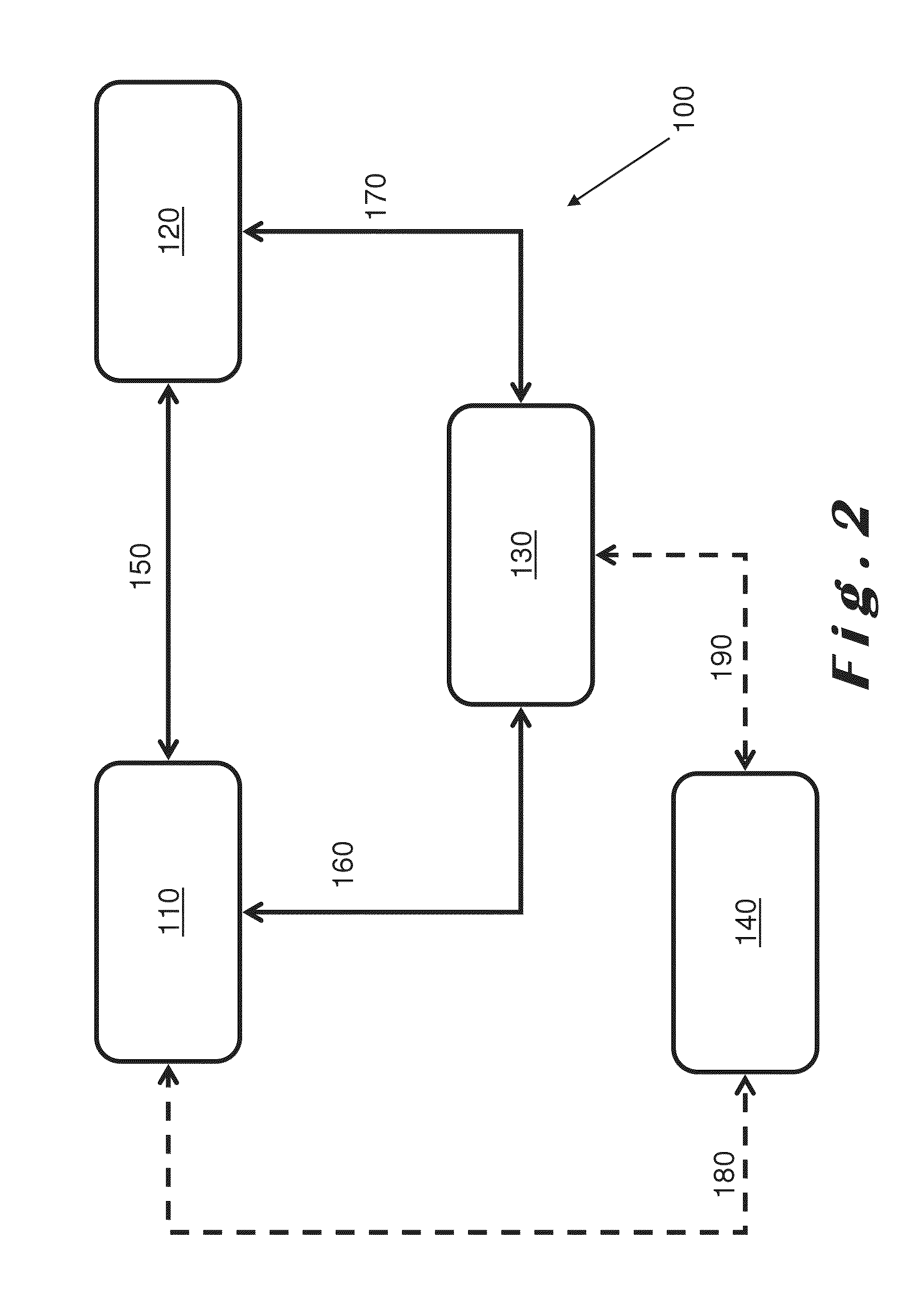

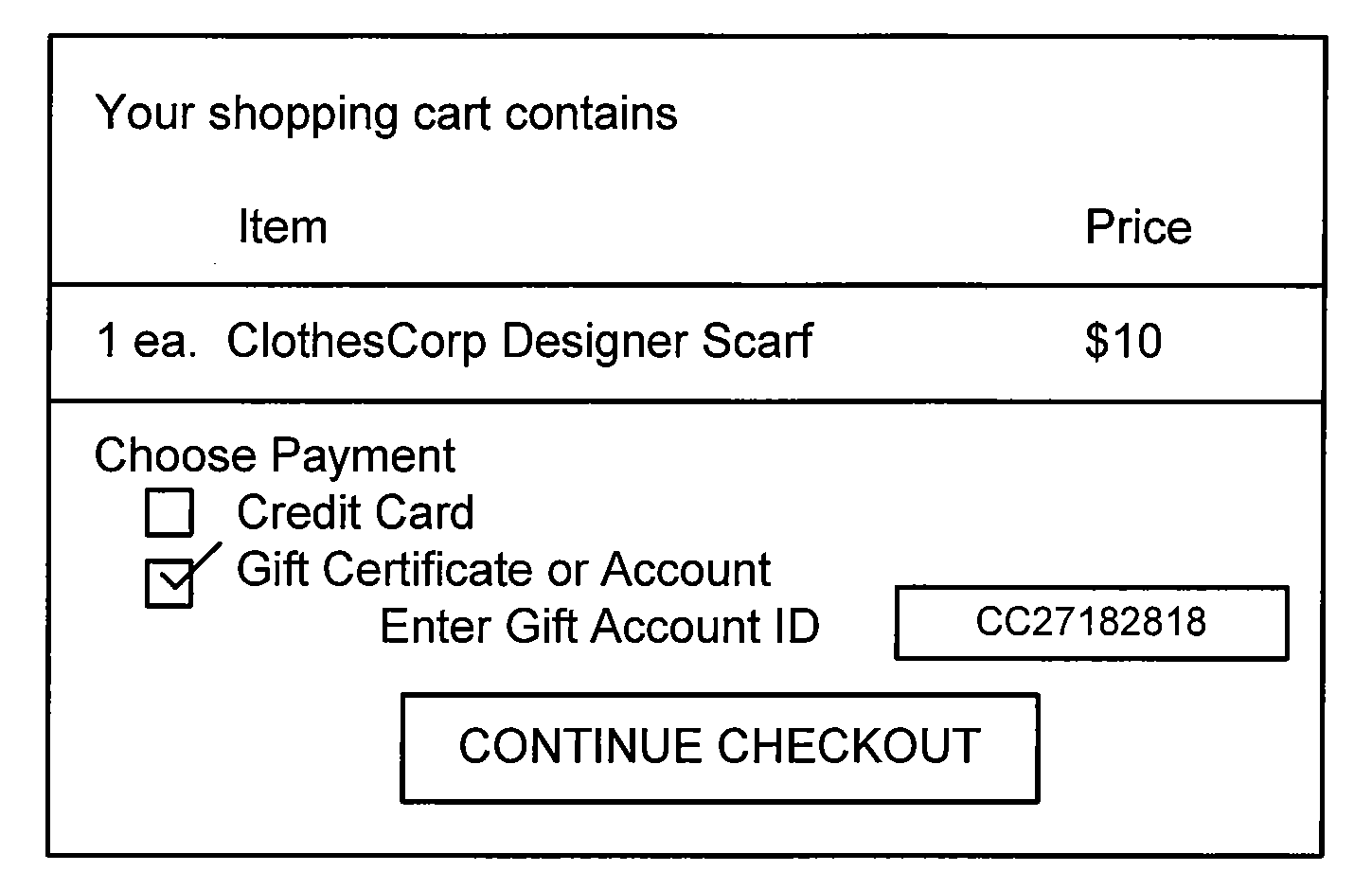

Described herein is a transaction system (100) in which a transaction is authenticated using an external alias. When procuring an item from a supplier (120), a customer (110) needs to provide payment in some form or the other. Profiles relating to both the customer (110) and the supplier (120) are stored in an environment managed by a broker (130) and payment is effected by transfer of within that environment from a customer wallet to a supplier wallet. The customer (120) is represented as an alias as far as the supplier (120) is concerned, whereby the alias is provided by an external identity provider (140) such as a social network with which the customer (120) is associated. The anonymity of the customer (120) is maintained with respect to the supplier (120).

Owner:DUBOIS PIETER

Systems and methods for stored-value exchange within social networking environments

Owner:FIRST DATA RESOURCES LLC

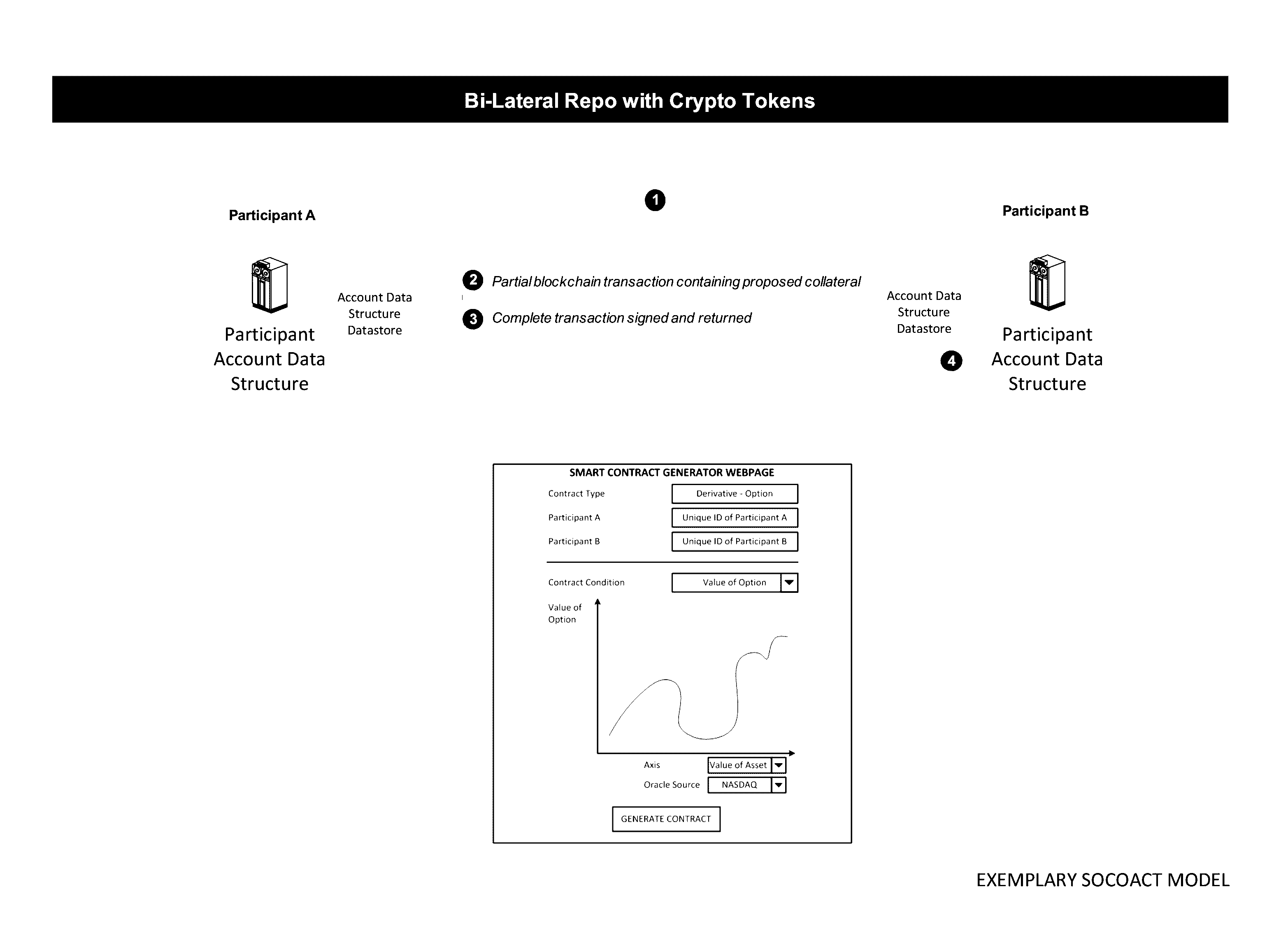

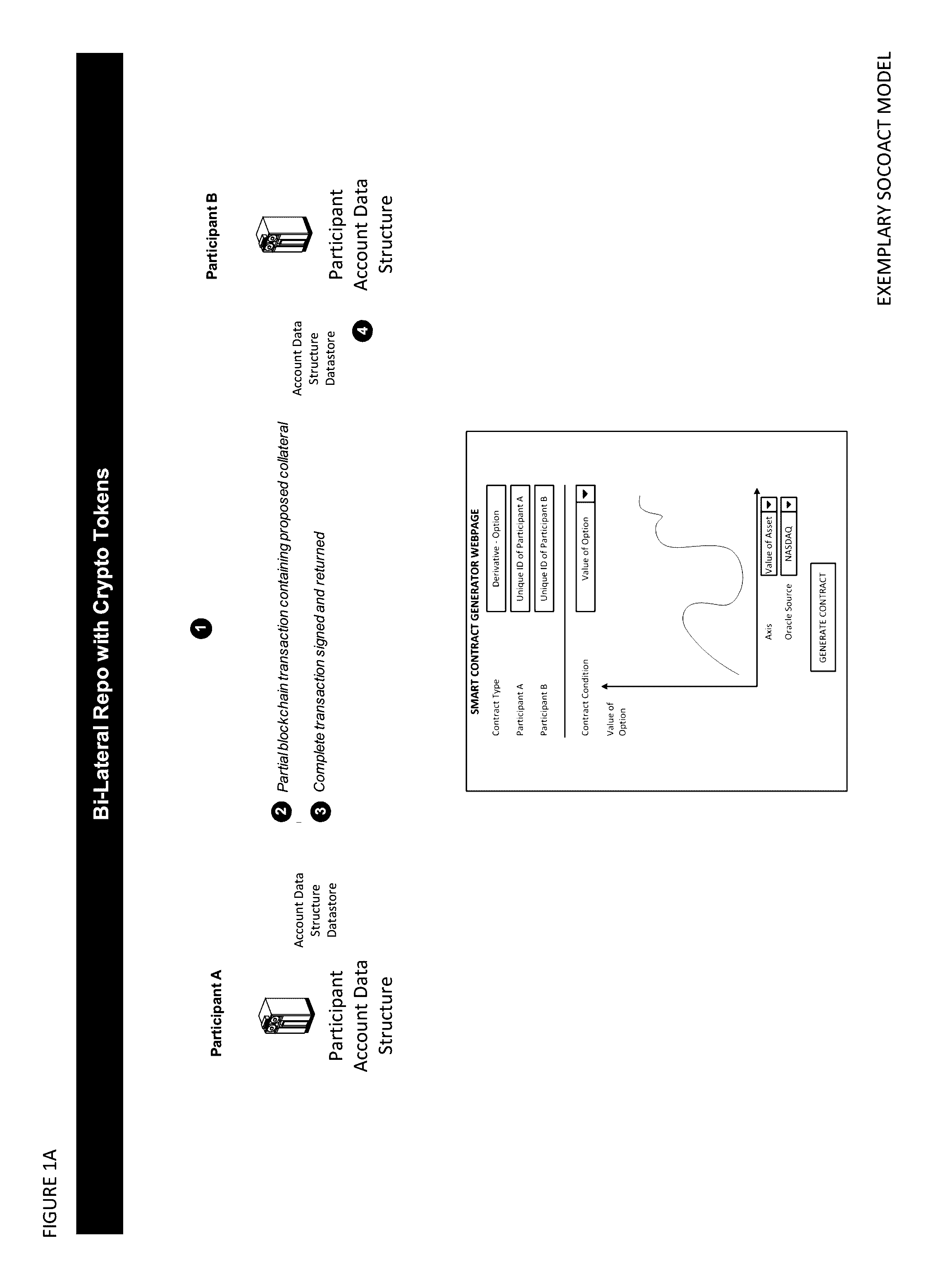

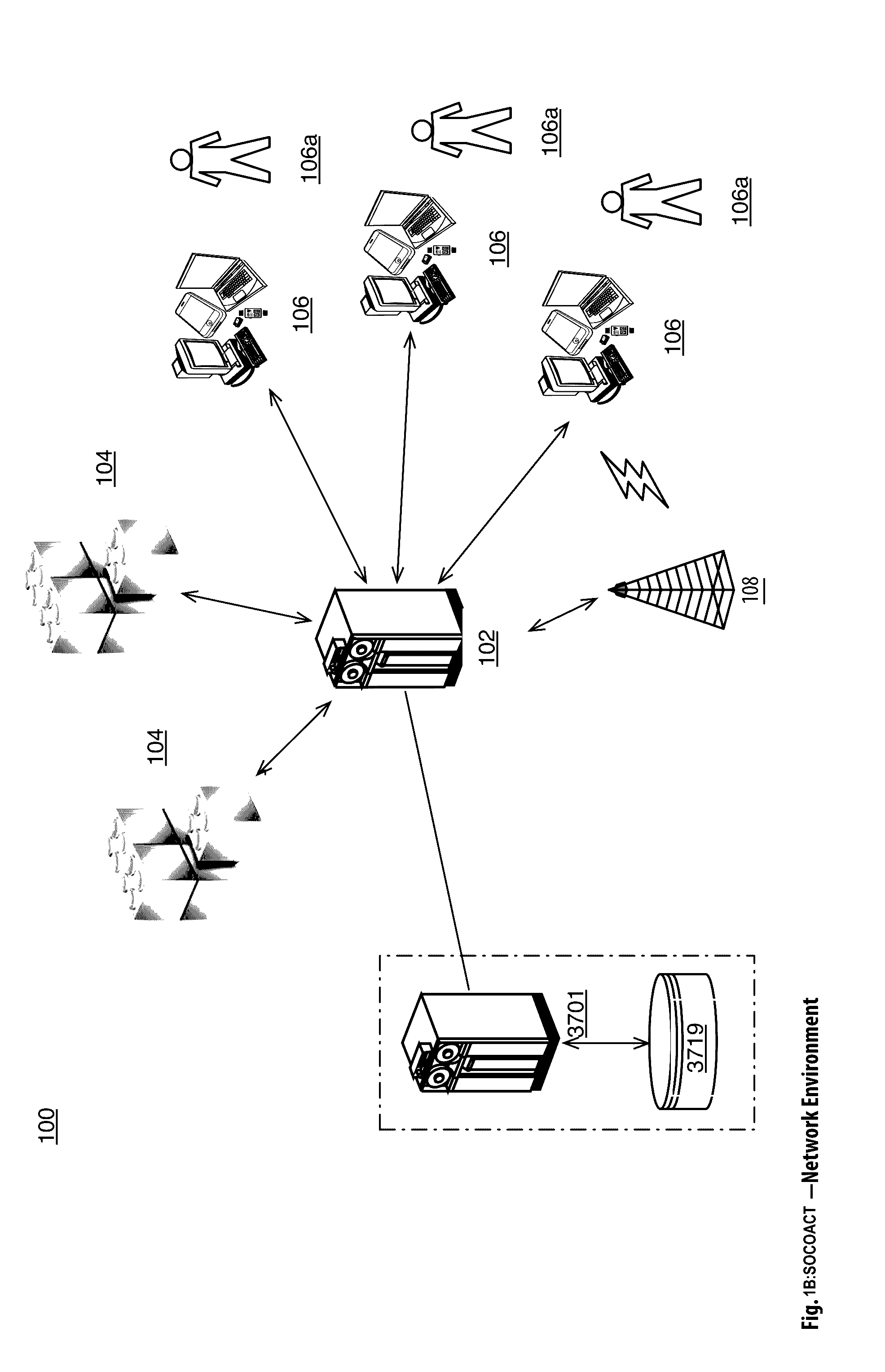

Crypto Key Recovery and Social Aggregating, Fractionally Efficient Transfer Guidance, Conditional Triggered Transaction, Datastructures, Apparatuses, Methods and Systems

InactiveUS20170048209A1Multiple keys/algorithms usageCryptography processingData structureKey recovery

The Crypto Key Recovery and Social Aggregating, Fractionally Efficient Transfer Guidance, Conditional Triggered Transaction, Datastructures, Apparatuses, Methods and Systems (“SOCOACT”) transforms MKADSD generation request, trigger event message inputs via SOCOACT components into transaction confirmation, recovery notification outputs. A multiple key account data structure datastore (MKADSD) generation request may be obtained from a user. A set of crypto public keys for a MKADSD may be determined. The MKADSD may be instantiated in a socially aggregated blockchain datastructure using the determined set of crypto public keys. A crypto recovery private key may be associate with the MKADSD and trigger event recovery settings for the MKADSD may be set. A trigger event message associated with the MKADSD may be obtained and recovery settings associated with a trigger event may be determined. The crypto recovery private key may be retrieved and a recovery action may be facilitated.

Owner:FMR CORP

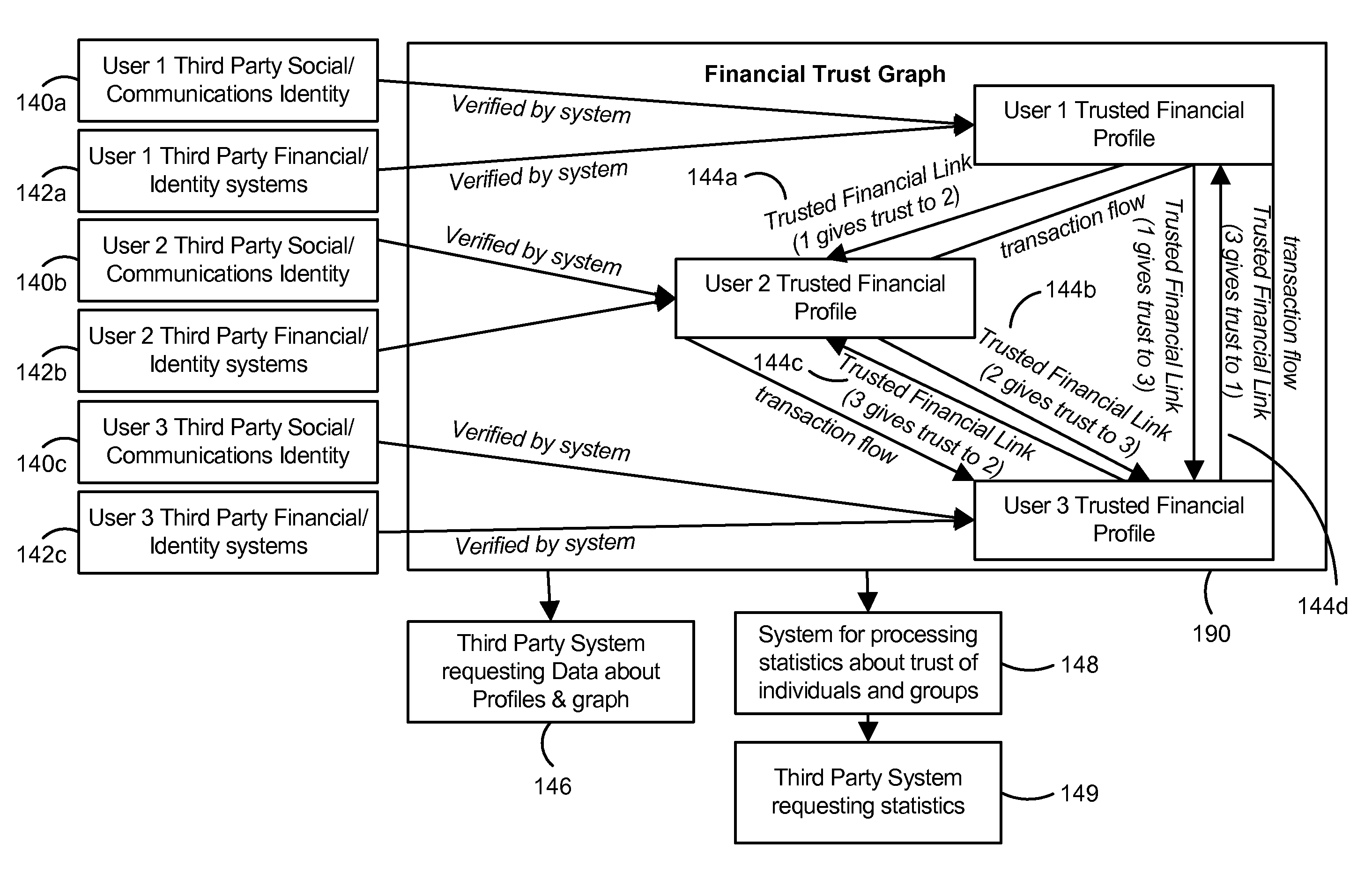

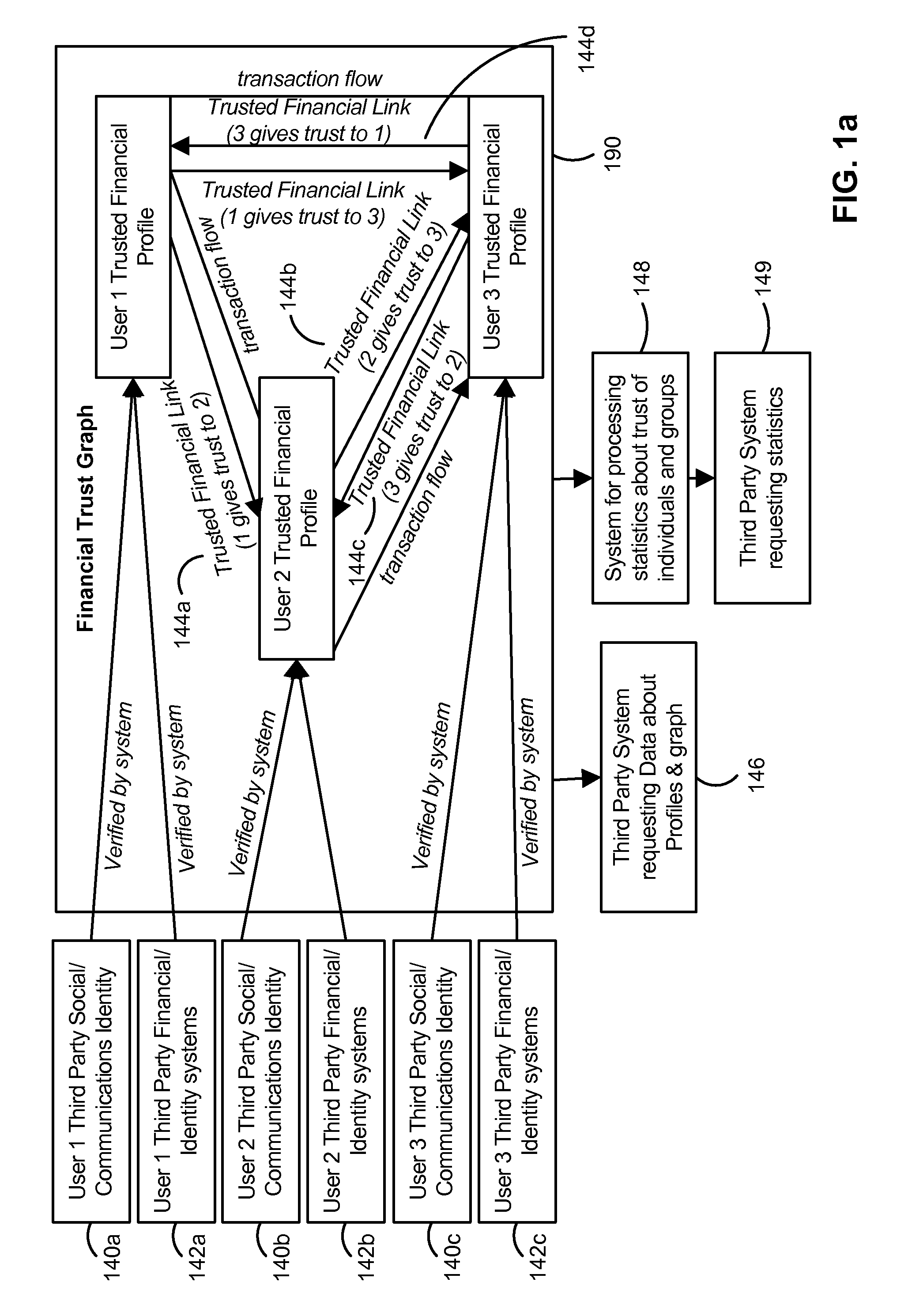

Trust Based Transaction System

A configuration for more efficient electronic financial transactions is disclosed. Users input personal and financial information into a system that validates the information to generate trusted financial profiles. Each user can establish trusted financial links with other users. The trusted financial link provides a mechanism for the user to allow other users to withdraw money from the link provider account. The data from these relationships and the financial data flowing through the system enable a measure of trustworthiness of users and the trustworthiness of all interactions in the system. The combination of trusted financial profiles, trusted financial links, and financial transactions between users create a measurable financial trust graph which is a true representation of the trusting economic relationships among the users. The financial trust graph enables a more accurate assessment of the creditworthiness and financial risk of transactions by users with little or no credit or transaction history.

Owner:PAYPAL INC

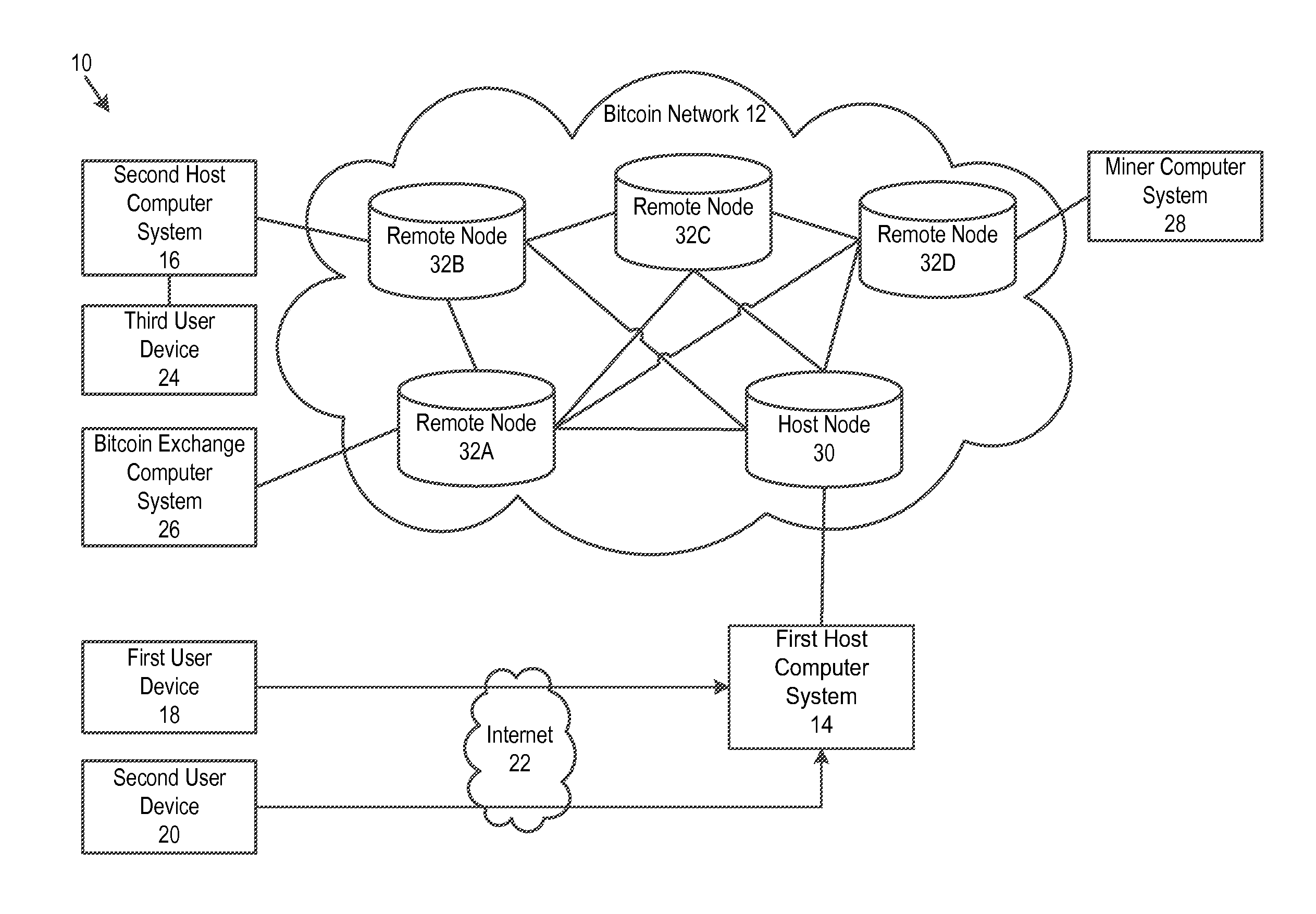

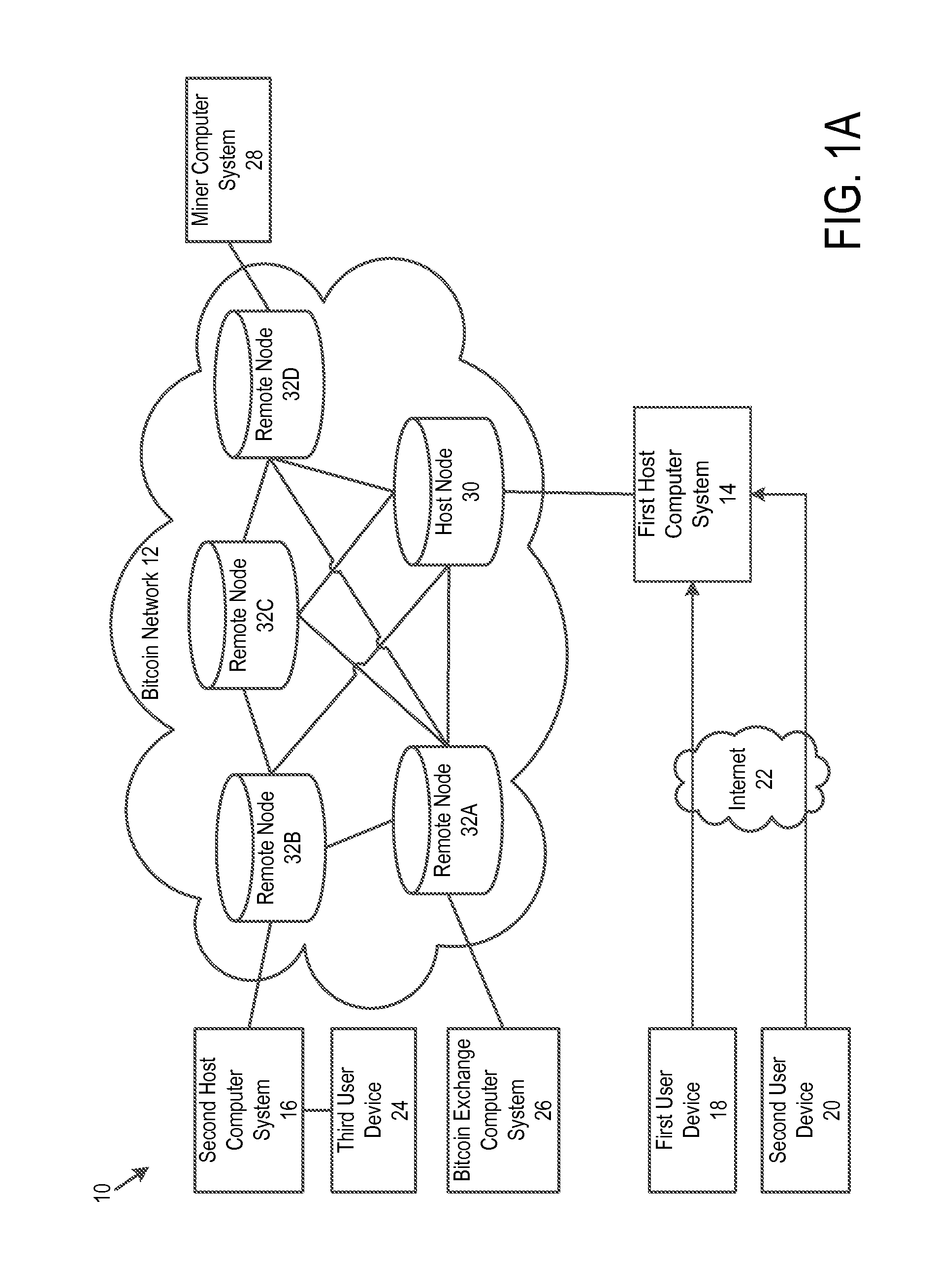

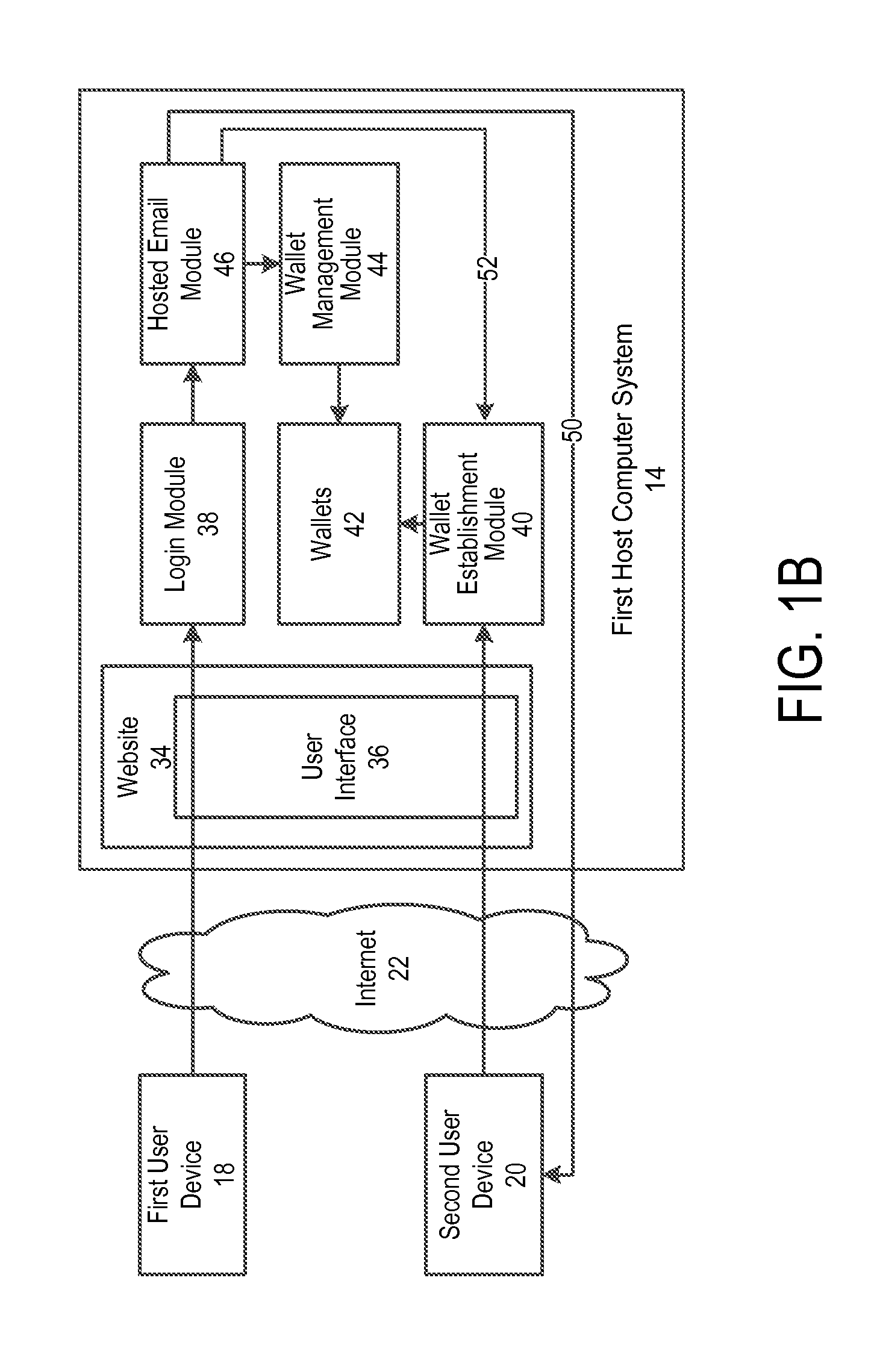

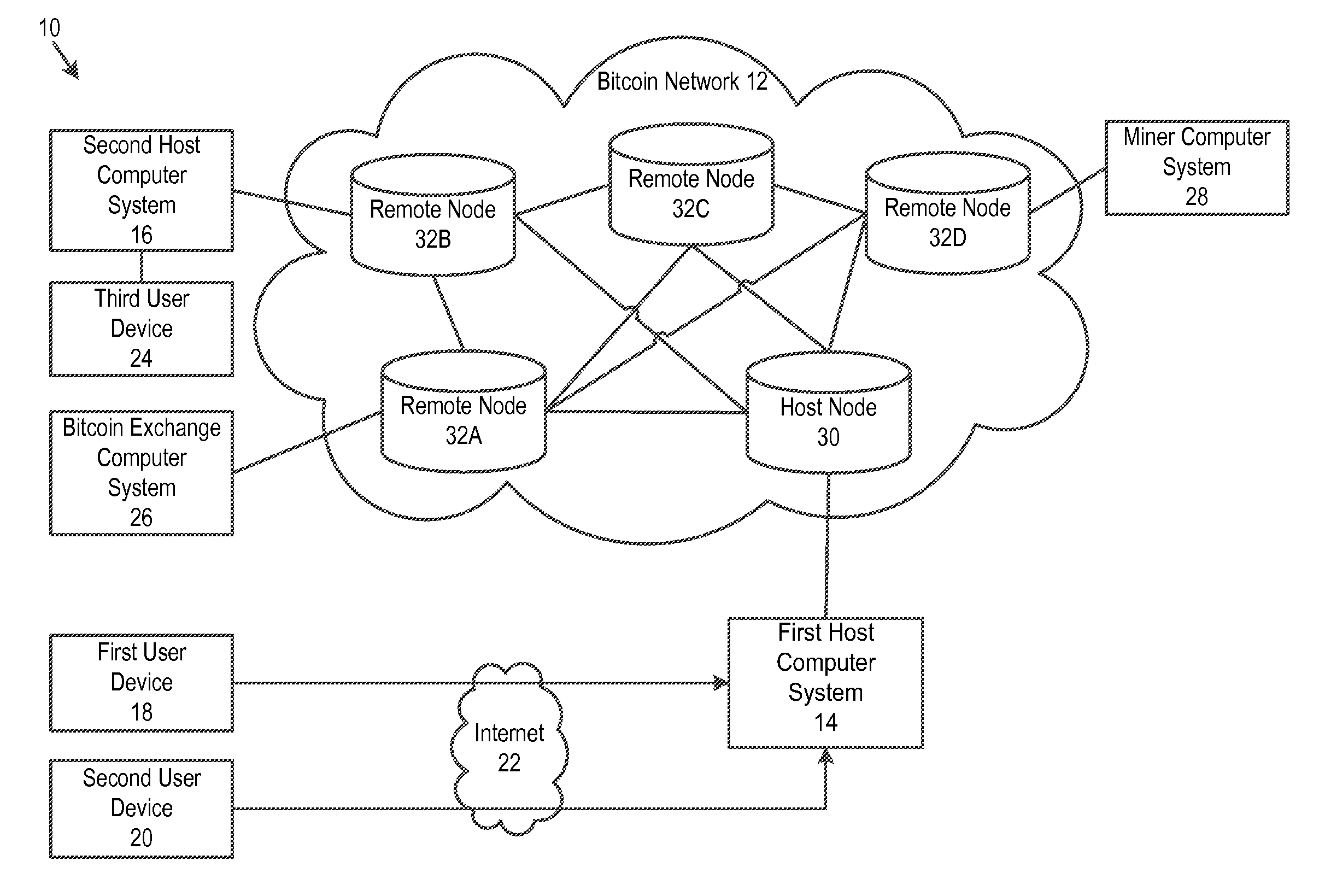

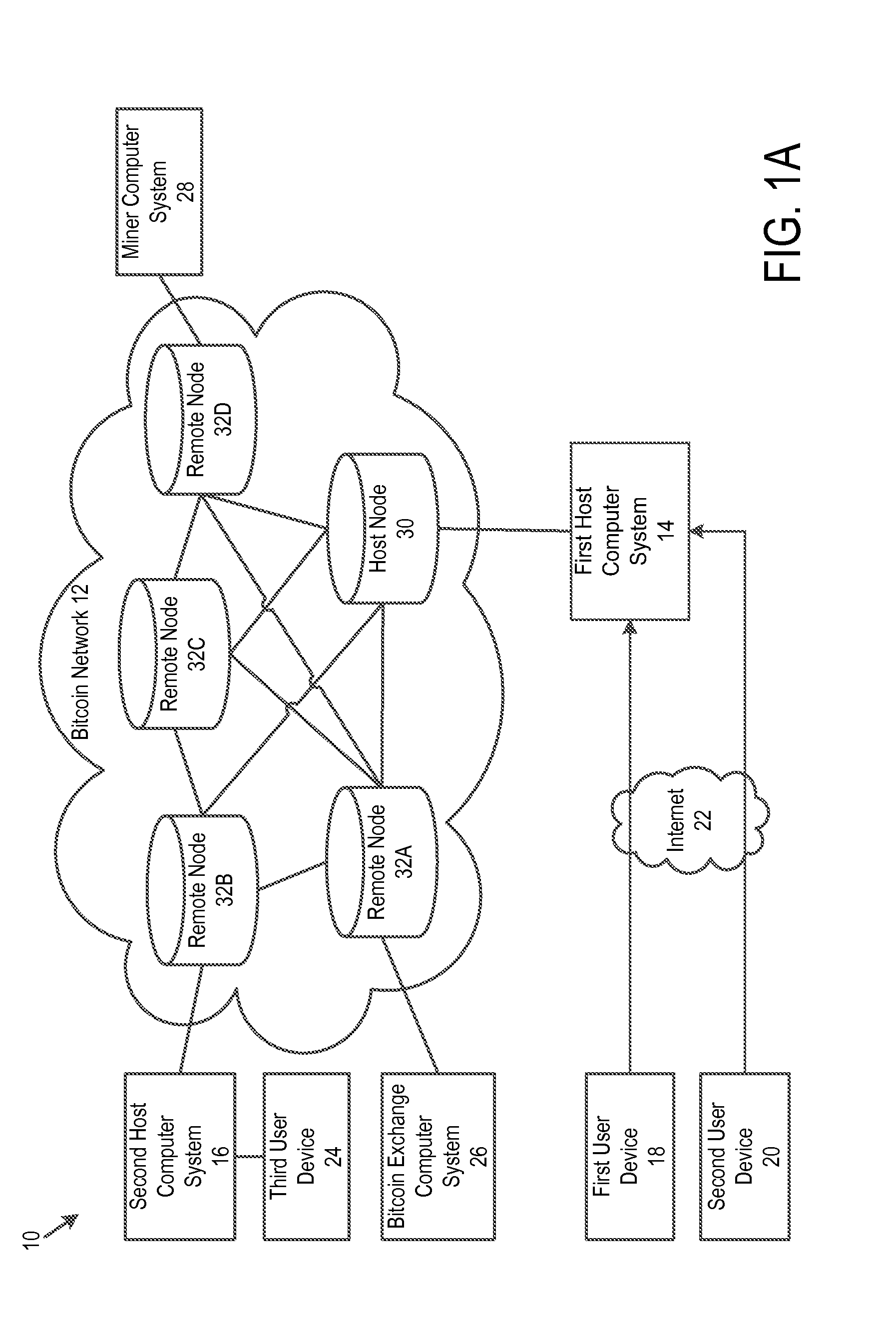

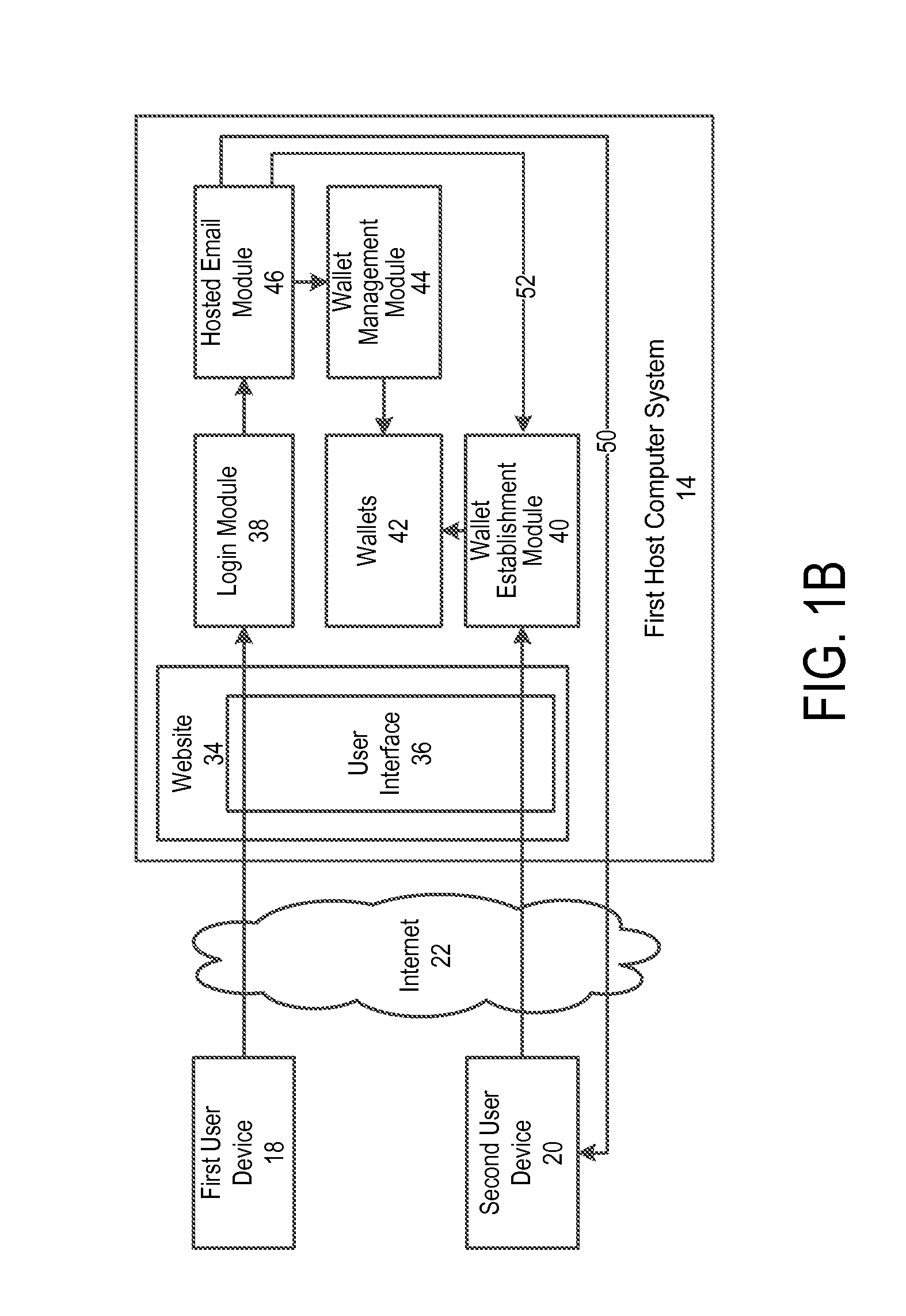

Off-block chain transactions in combination with on-block chain transactions

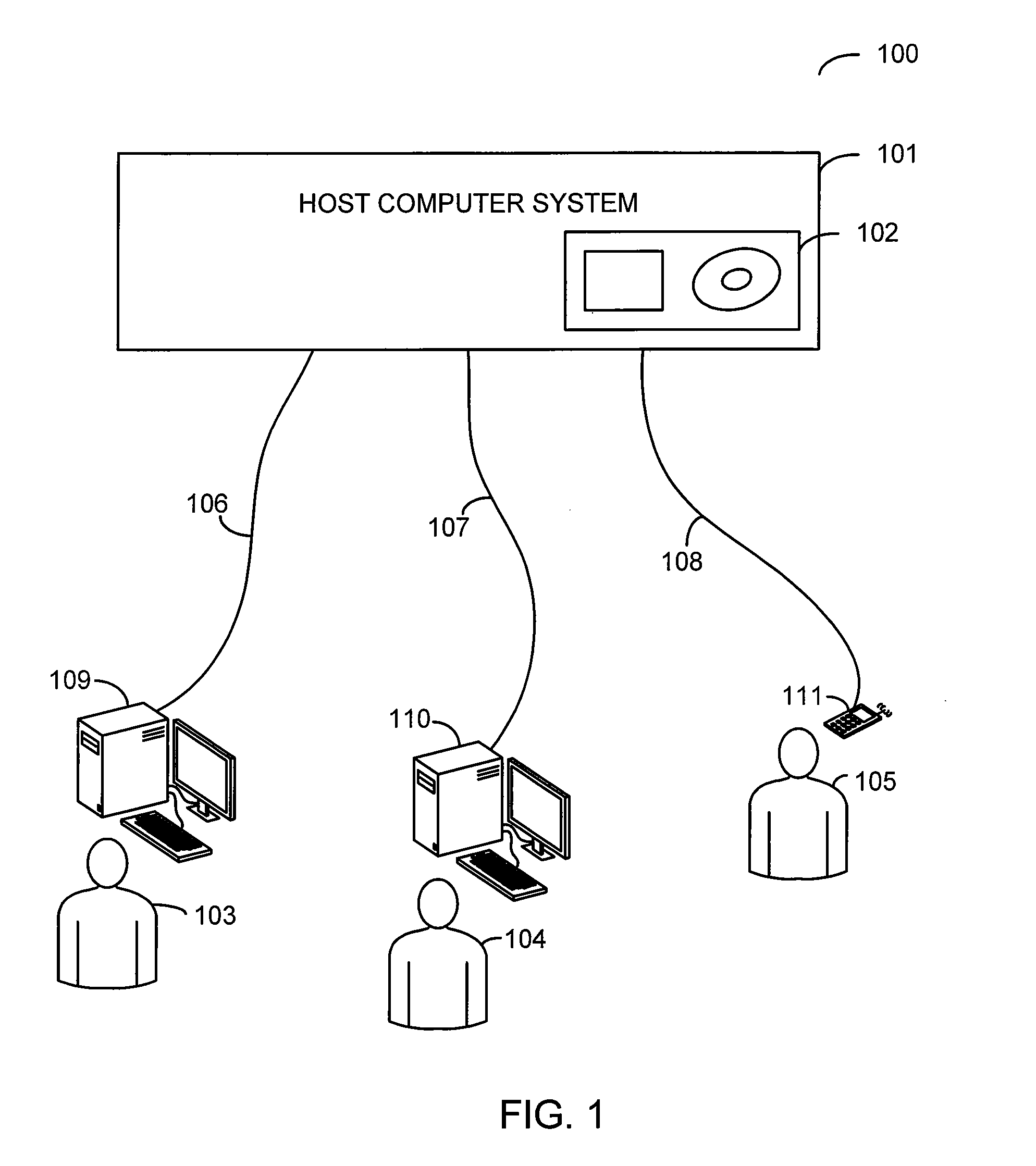

A system and method for transaction bitcoin is described. Bitcoin can be sent to an email address. No miner's fee is paid by a host computer system. Hot wallet functionality is provided that transfers values of some Bitcoin addresses to a vault for purposes of security. A private key of a Bitcoin address of the vault is split and distributed to keep the vault secure. Instant exchange allows for merchants and customers to lock in a local currency price. A vault has multiple email addresses to authorize a transfer of bitcoin out of the vault. User can opt to have private keys stored in locations that are under their control. A tip button rewards content creators for their efforts. A bitcoin exchange allows for users to set prices that they are willing to sell or buy bitcoin and execute such trades.

Owner:COINBASE

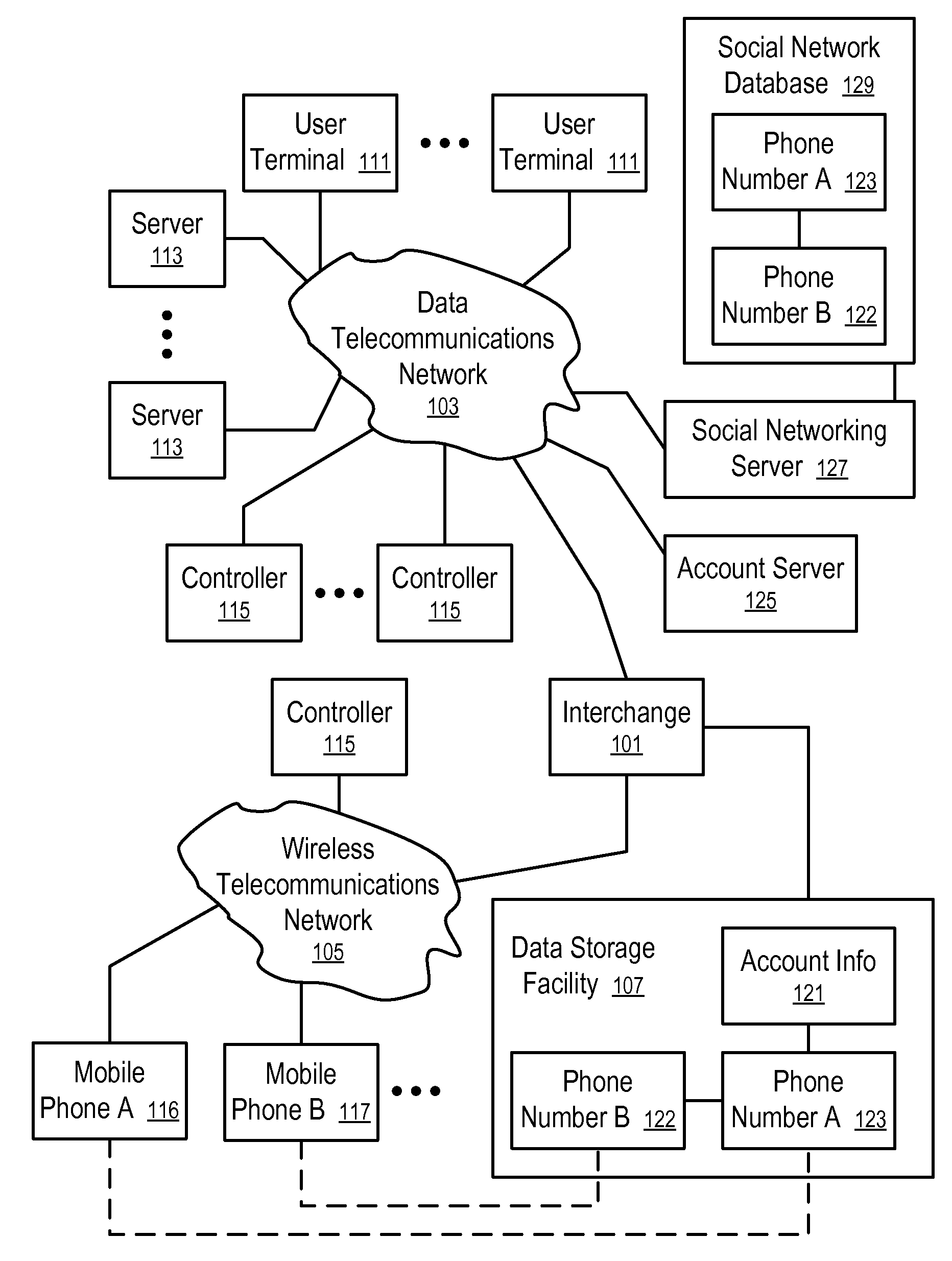

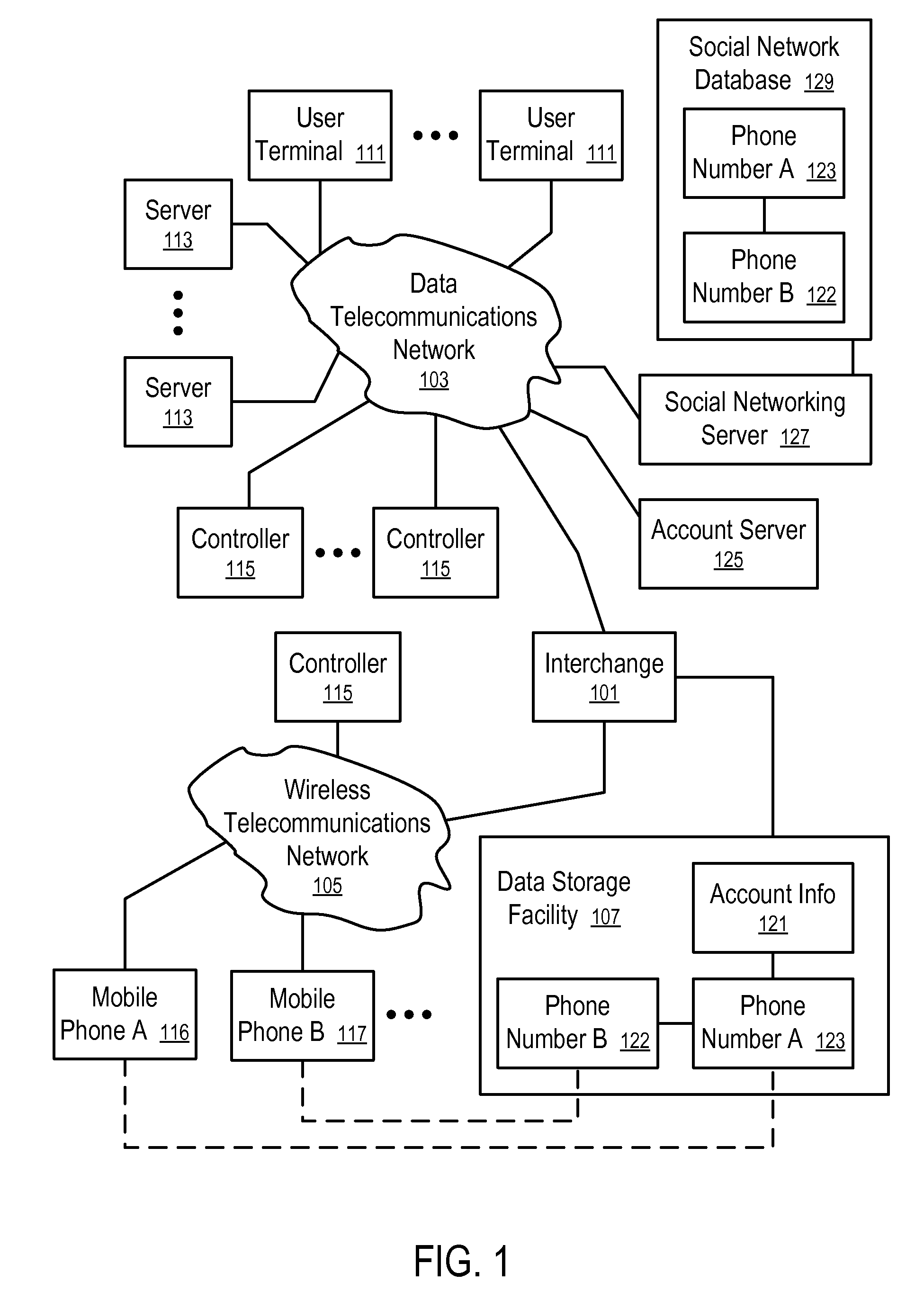

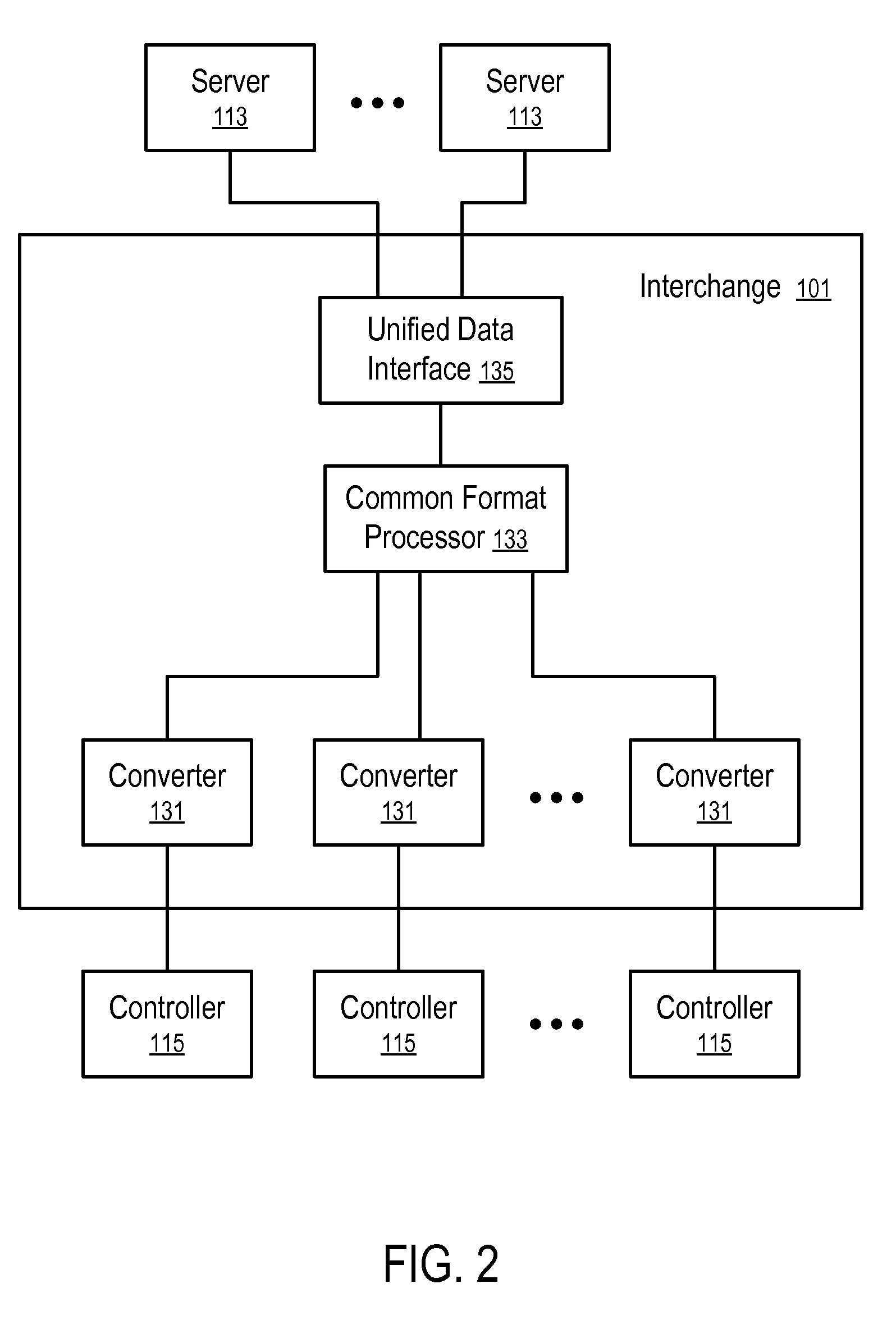

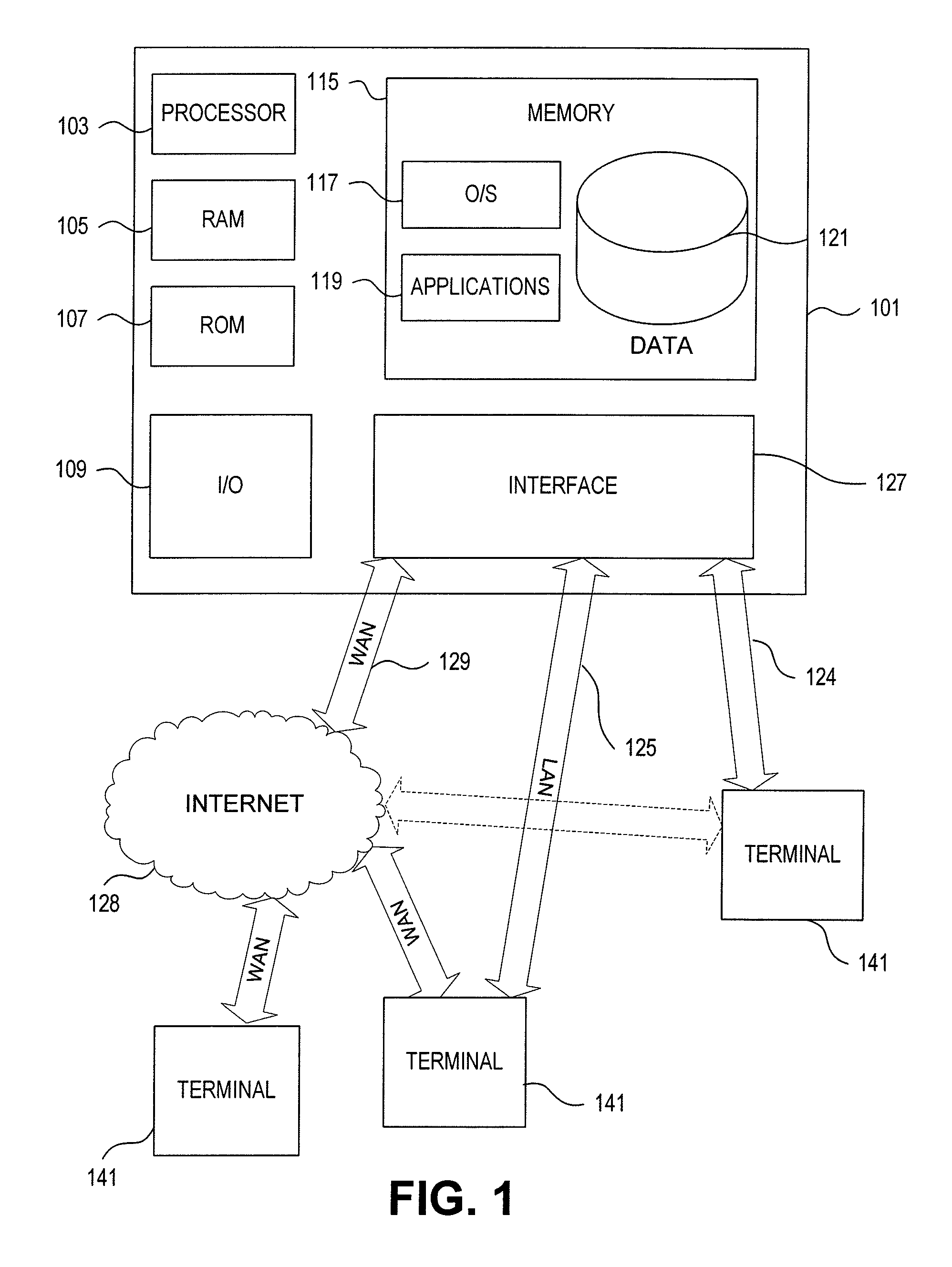

Systems and Methods to Process Transactions Based on Social Networking

Systems and methods to authenticate and process requests received via social networking websites. In one aspect, a system includes a data storage facility to store data associating a first phone number of a user with an identification of the user in a social networking website; and an interchange coupled with the data storage facility. The interchange includes a common format processor and a plurality of converters to interface with a plurality of controllers of mobile communications. The converters communicate with the controllers in different formats and with the common format processor in a common format. The common format processor receives a request including the identification of the user, identifies the first phone number of the user based on the data stored on the data storage facility, and uses the converters to communicate with a mobile phone at the first phone number to confirm the request.

Owner:BOKU

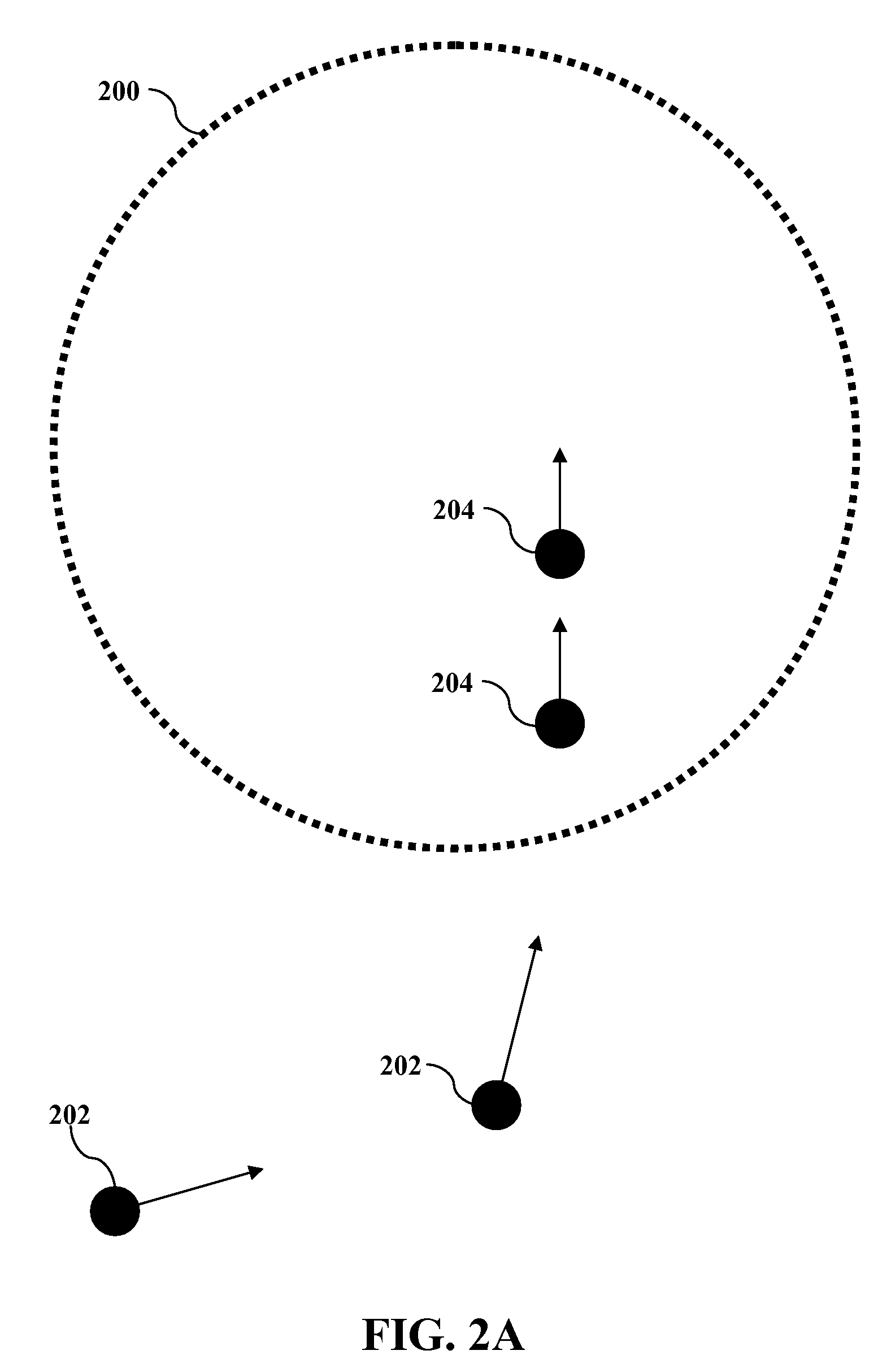

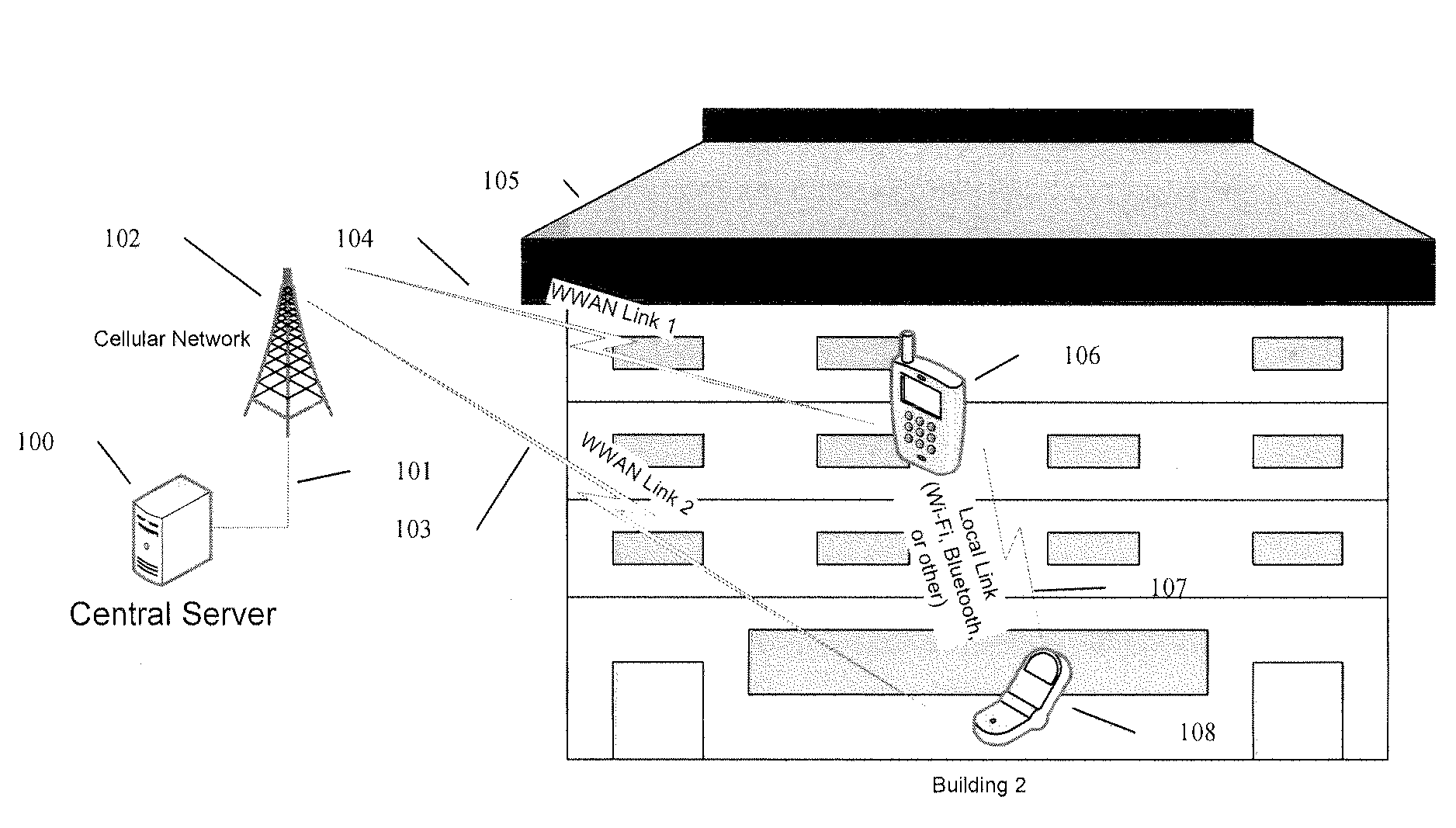

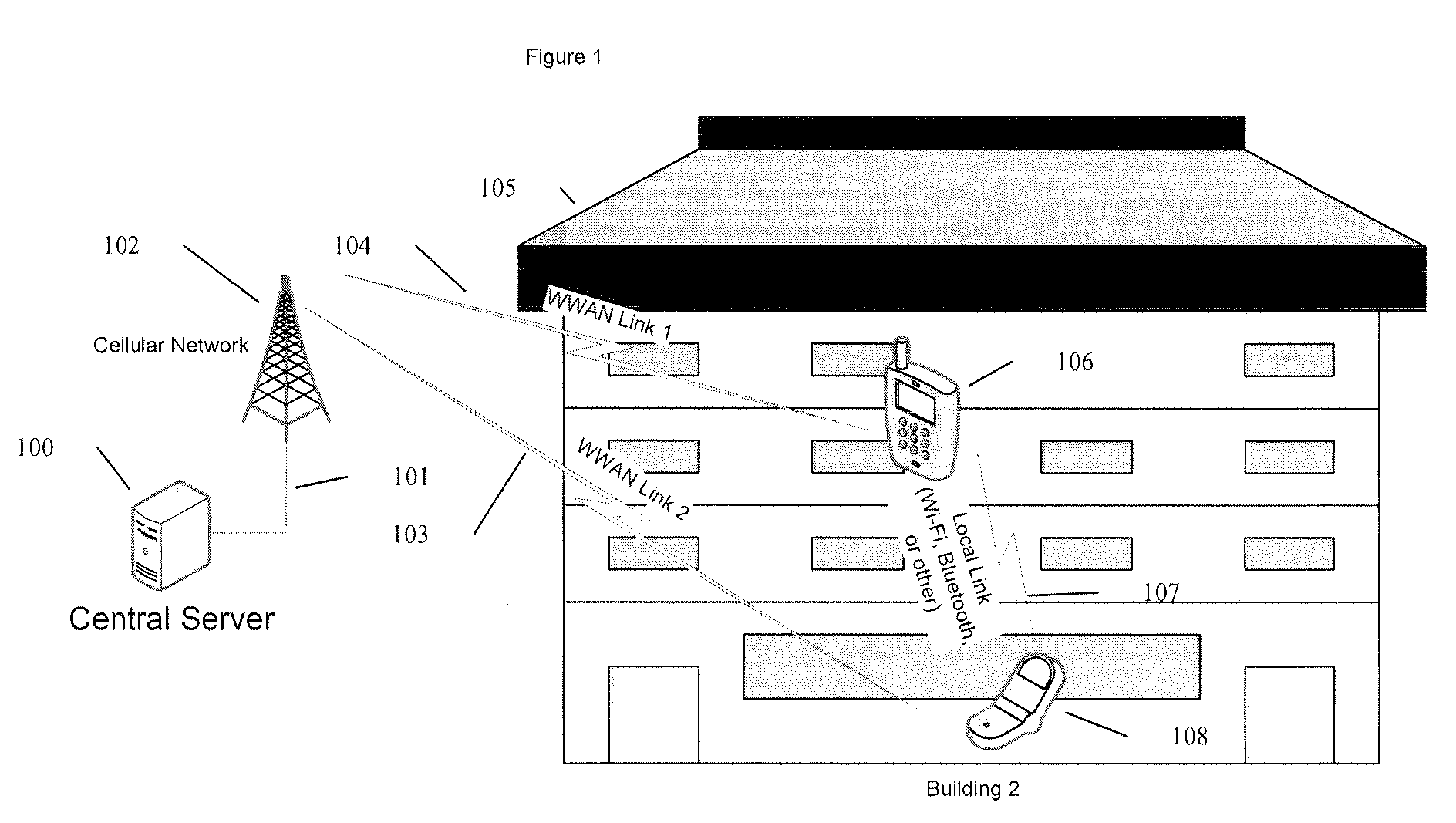

Enforcing policies in wireless communication using exchanged identities

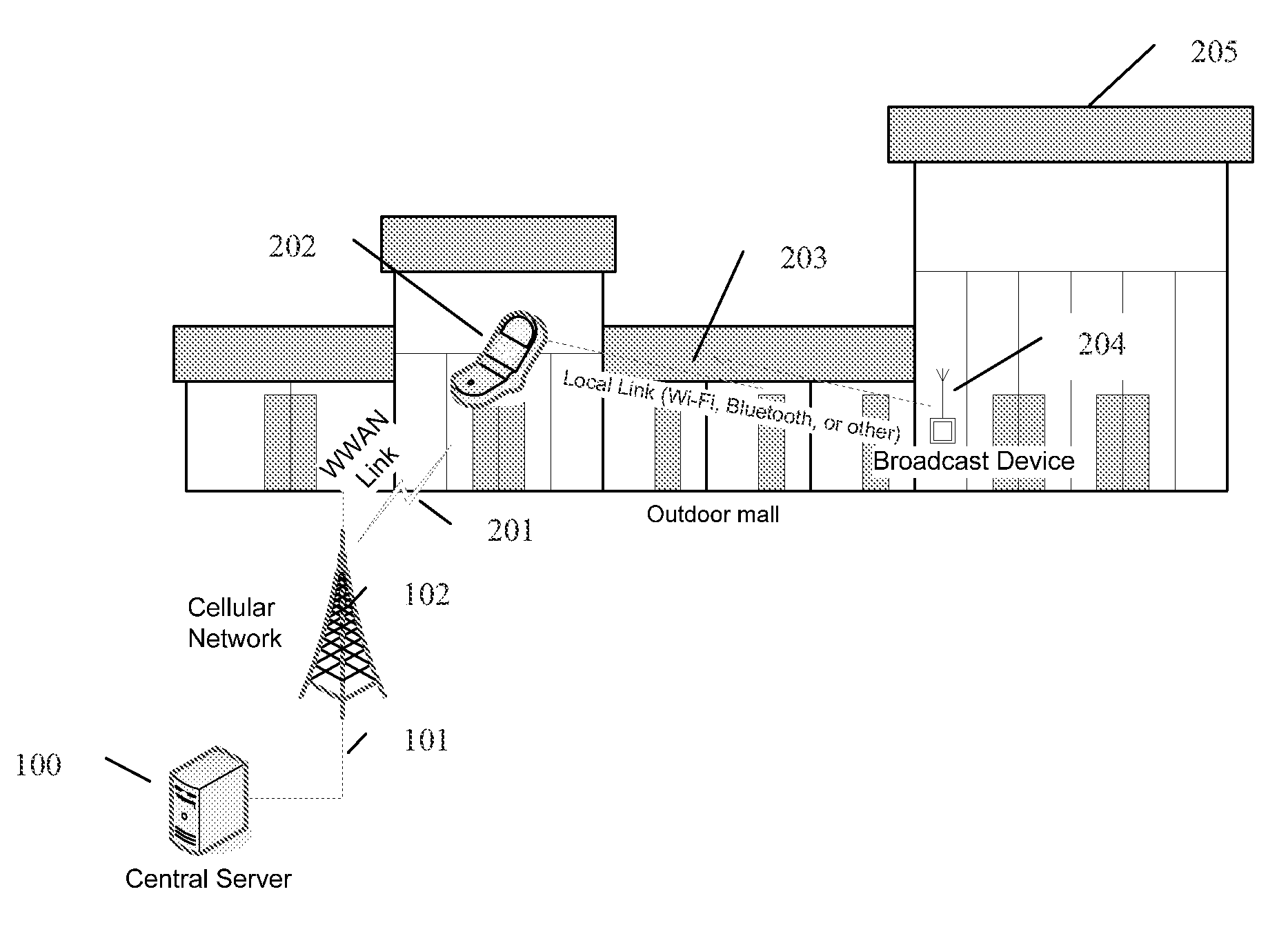

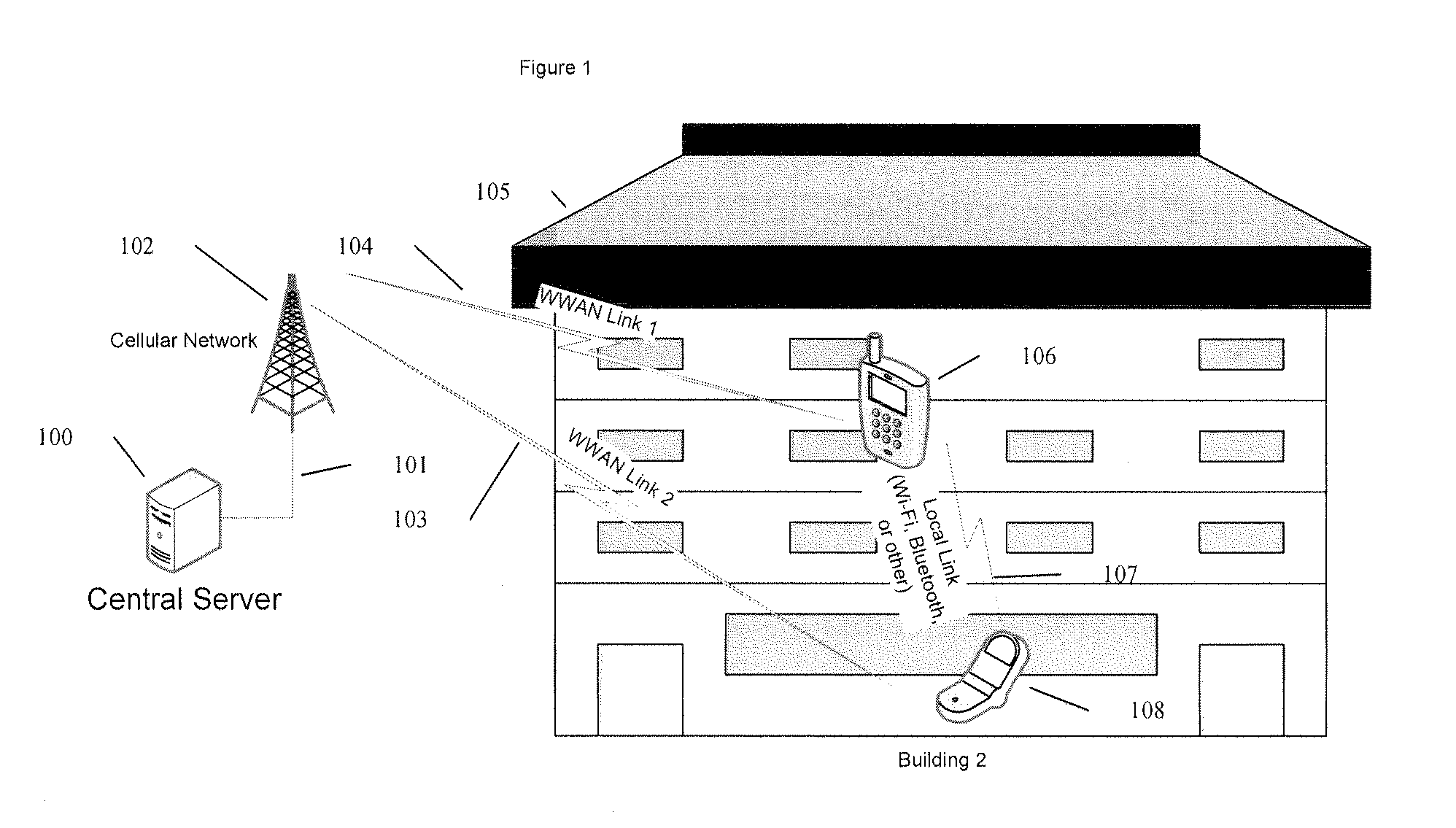

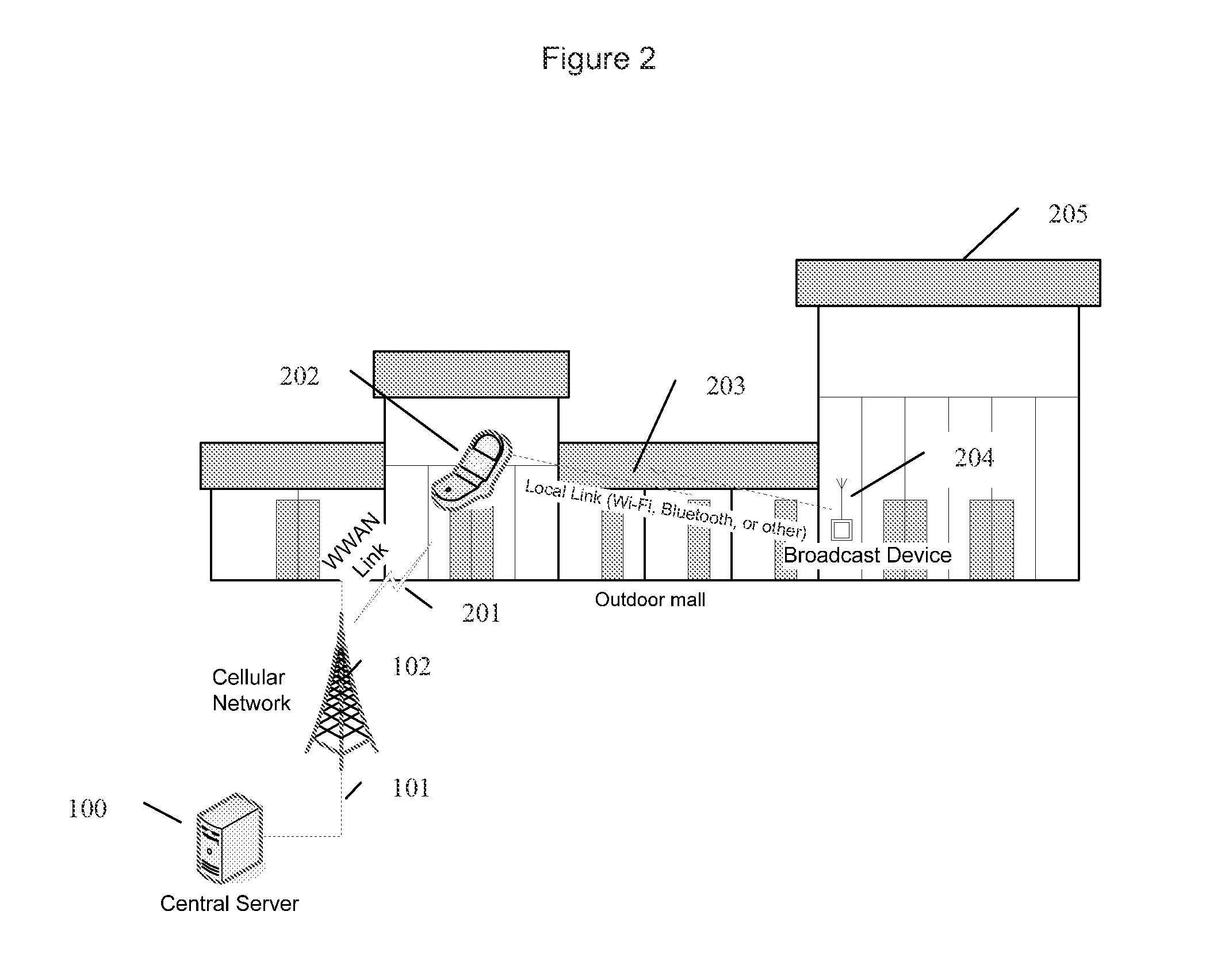

ActiveUS7936736B2Facilitating exchange of information and transactionShort capabilityDiscounts/incentivesServices signallingWi-FiComputer network

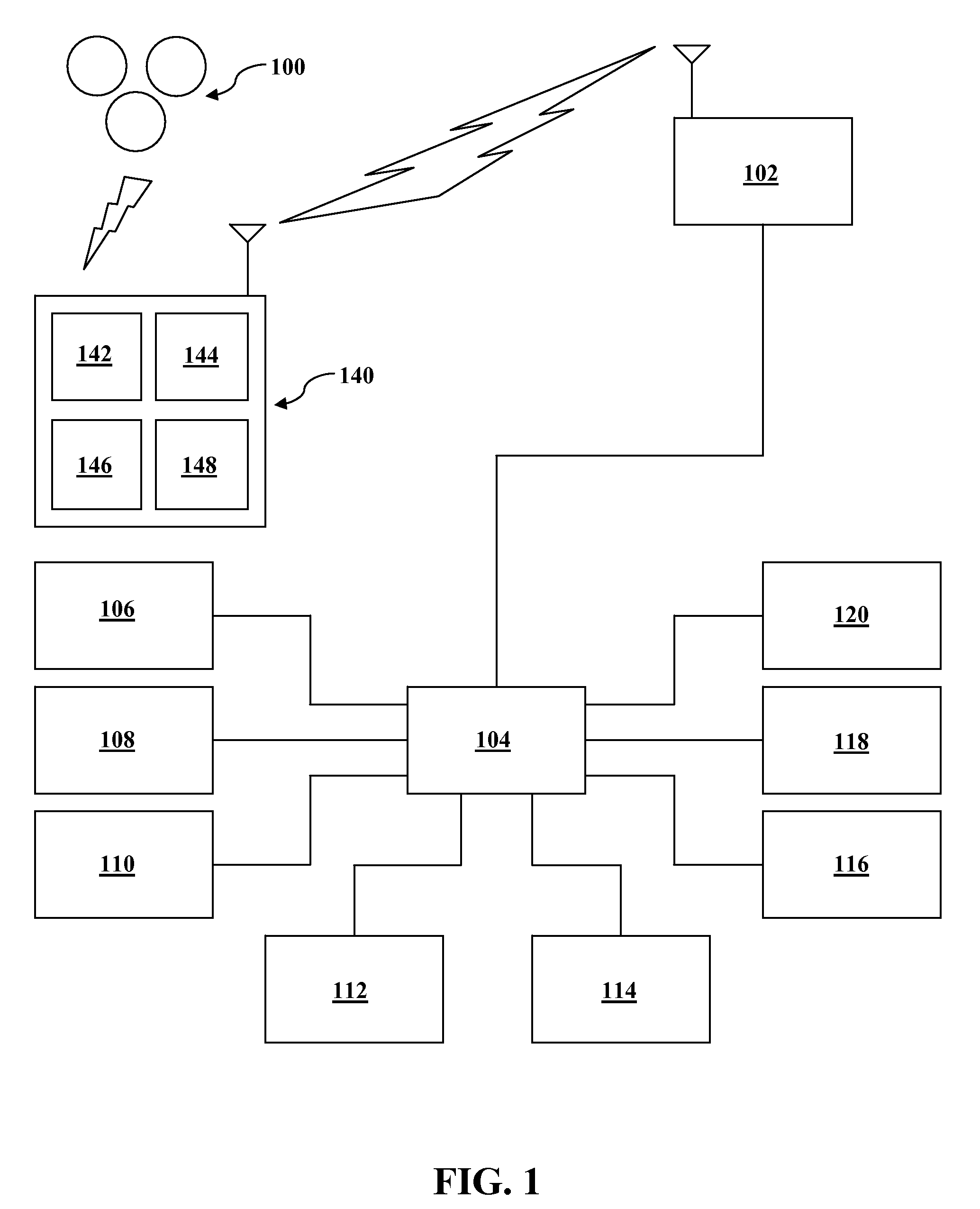

Techniques for facilitating the exchange of information and transactions between two entities associated with two wireless devices when the devices are in close proximity to each other. A first device uses a first short range wireless capability to detect an identifier transmitted from a second device in proximity, ideally using existing radio capabilities such as Bluetooth (IEEE802.15.1-2002) or Wi-Fi (IEEE802.11). The detected identifier, being associated with the device, is also associated with an entity. Rather than directly exchanging application data flow between the two devices using the short range wireless capability, a second wireless capability allows for one or more of the devices to communicate with a central server via the internet, and perform the exchange of application data flow. By using a central server to draw on stored information and content associated with the entities the server can broker the exchange of information between the entities and the devices.

Owner:PROXICOM WIRELESS

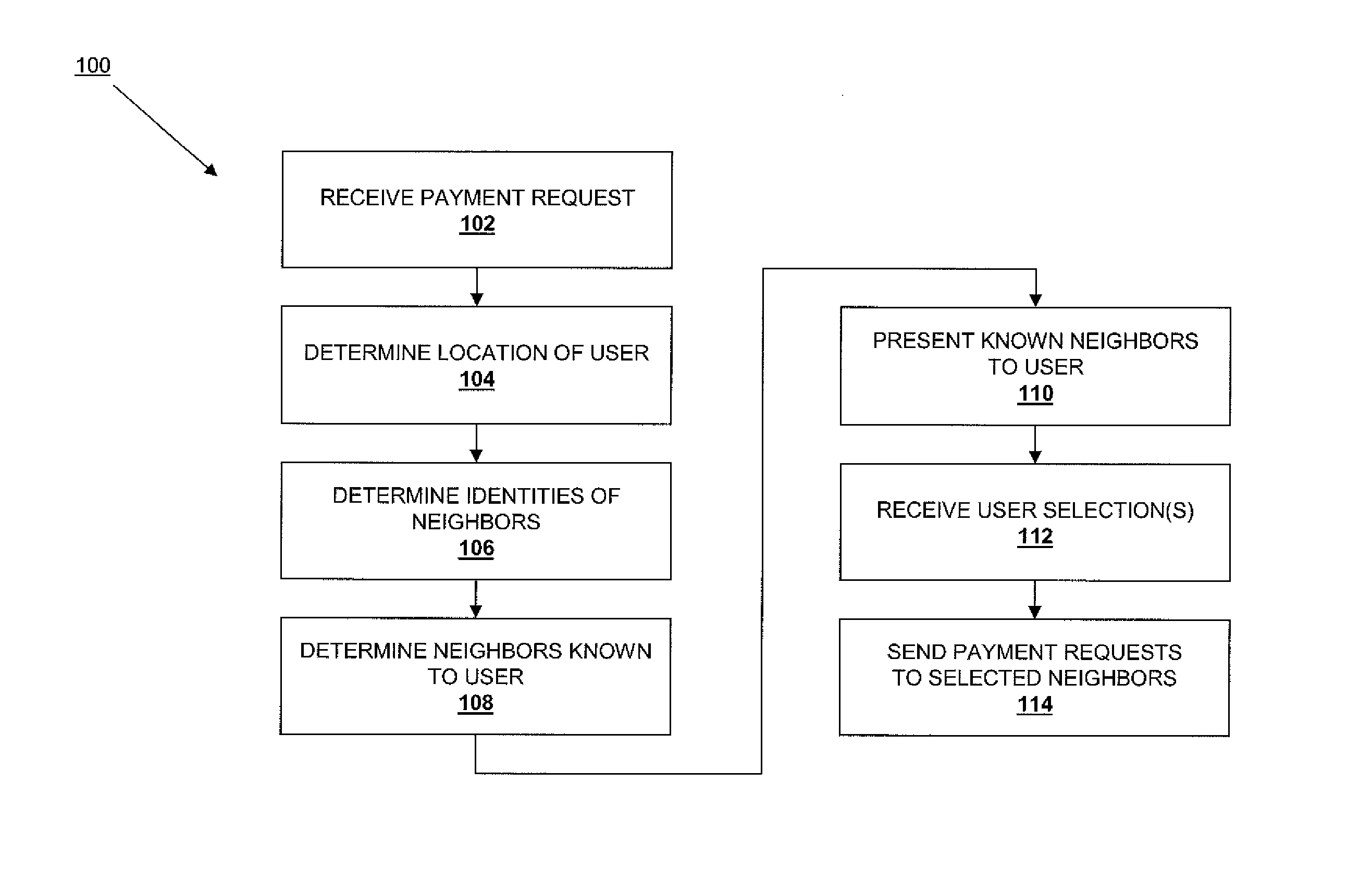

Social proximity payments

An application or App on a payer's mobile device is used to discover people known to the user and who are in close proximity to the user at the time of a payment request. Discovery can be through searching contact lists and / or social networks of the payer and / or through the payer device discovering contacts around the payer and then searching the payer's contact or social network list to see if there are any matches. These people are then shown to the user on the user device, such as with a photo, icon, name, and / or email address. The user selects desired ones, which causes requests to be sent to the selected people, such as through text, voice, or email, to the respective devices. The selected people can then easily confirm or authorize a payment be sent to the user or to a payee.

Owner:PAYPAL INC

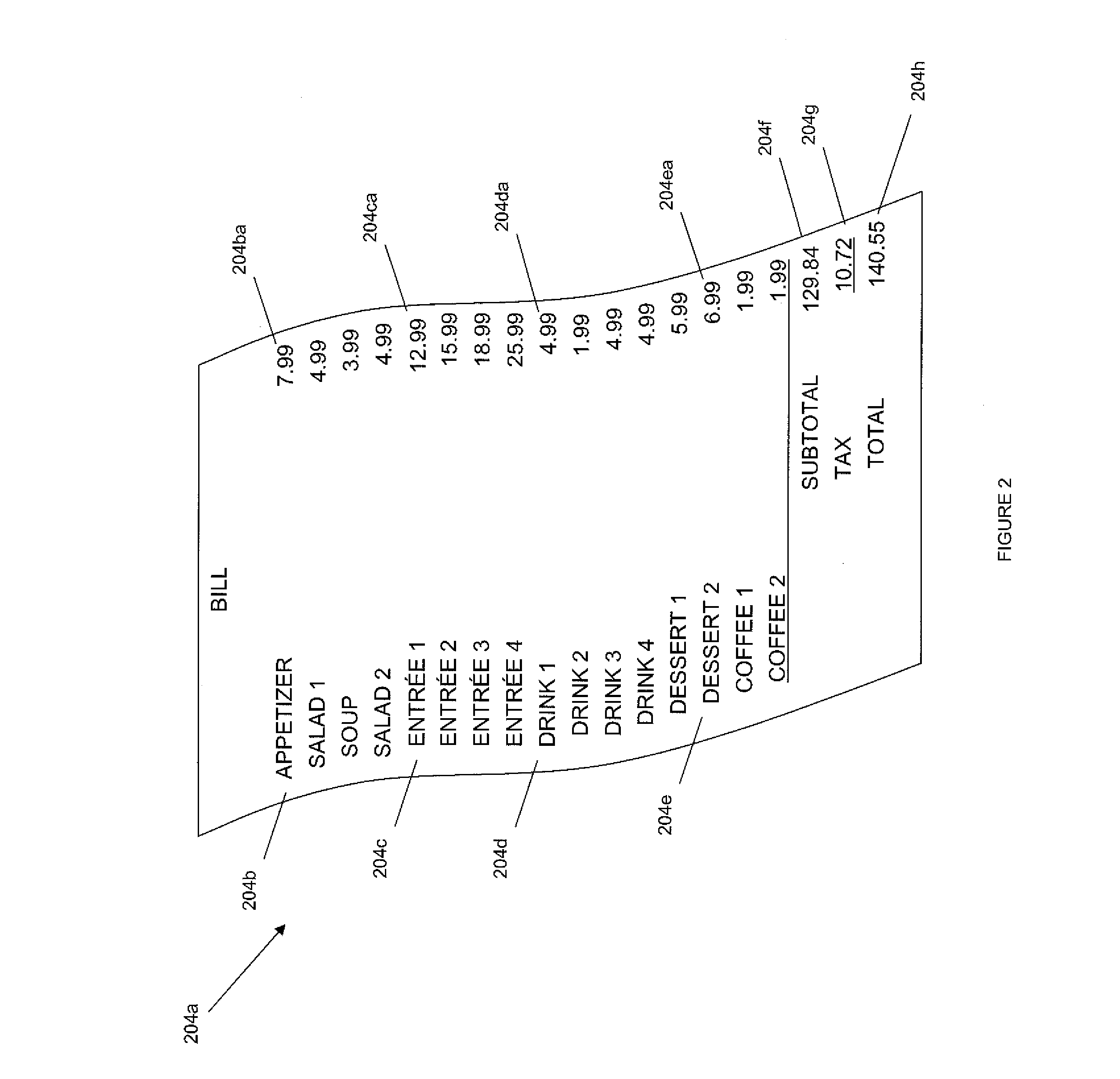

Secure messaging system

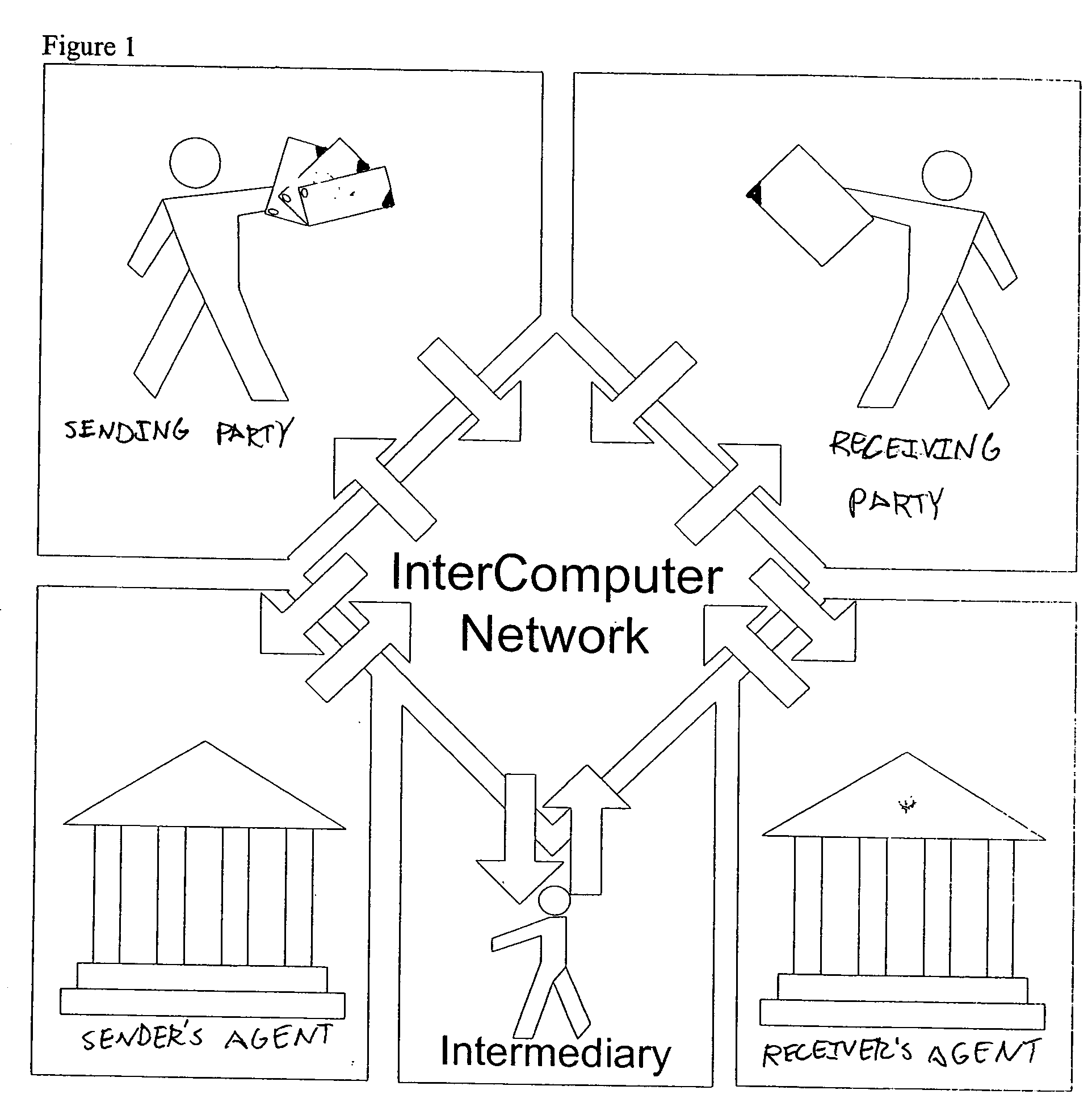

InactiveUS20050257045A1Guaranteed smooth progressUser identity/authority verificationPayment circuitsTransfer systemDocumentation

A method for secure data transactions over a computer network is described. In one embodiment, the act of generating at the first party a document, which authorizes the data transaction to proceed is performed. In one embodiment, the document content is signed using a computer network with audit-level encryption digital certificates. In one embodiment, a signed digital message (and / or document) is sent from the first party to the network transfer system electronically, and can be authenticated via the ICN certificate authorities to demonstrate the authorities of the signer of the signed document in assent to the transaction. In one embodiment, a copy of the signed digital document can be stored in a database associated with the transfer network system. In one embodiment, the system uses rules (patterns) of exchange agreed upon within and between organizations. These rules enable the exchange to progress smoothly and drive systematically the attention of participants to demands and problems etc. as a given transaction goes along.

Owner:INTERCOMP CORP

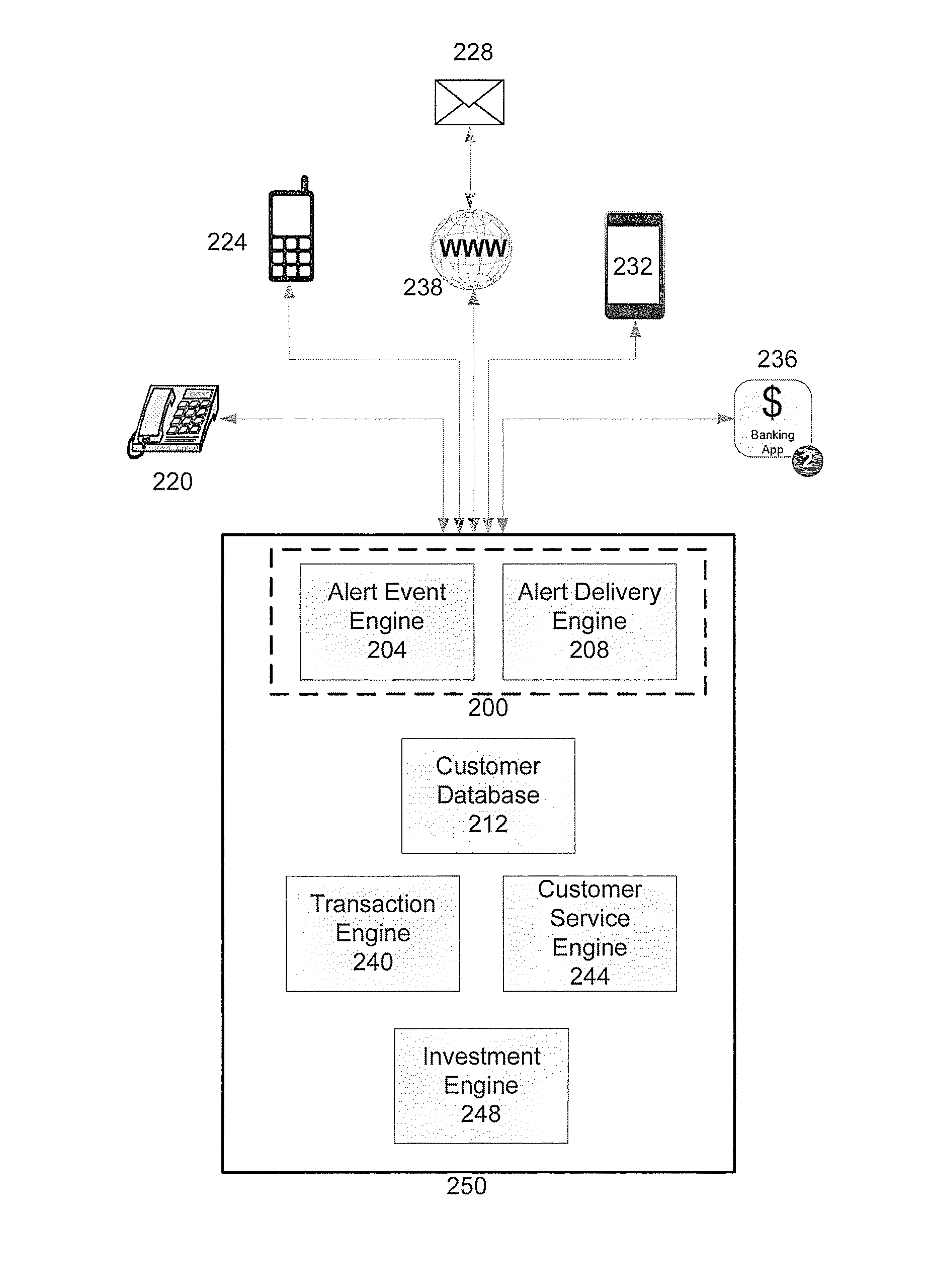

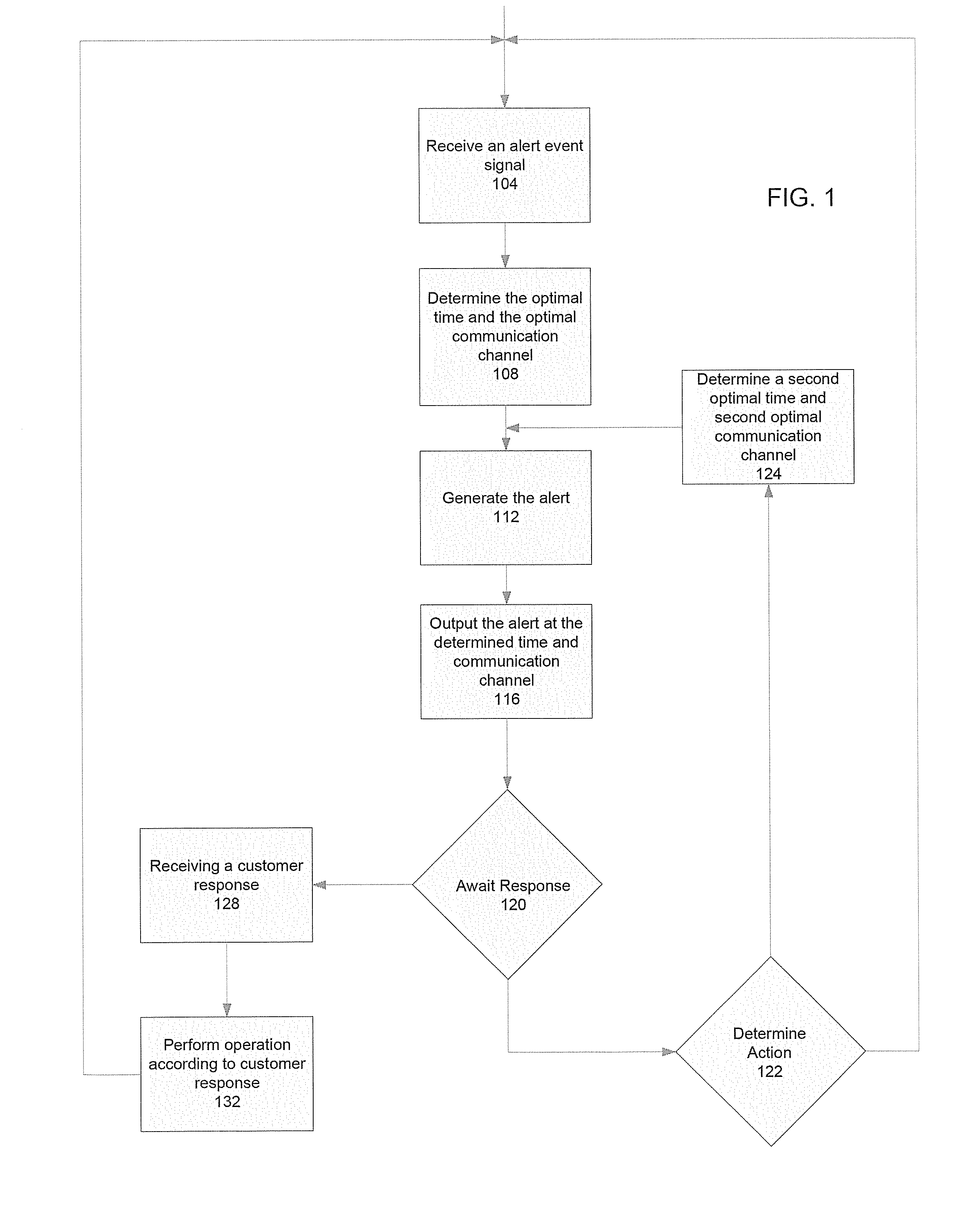

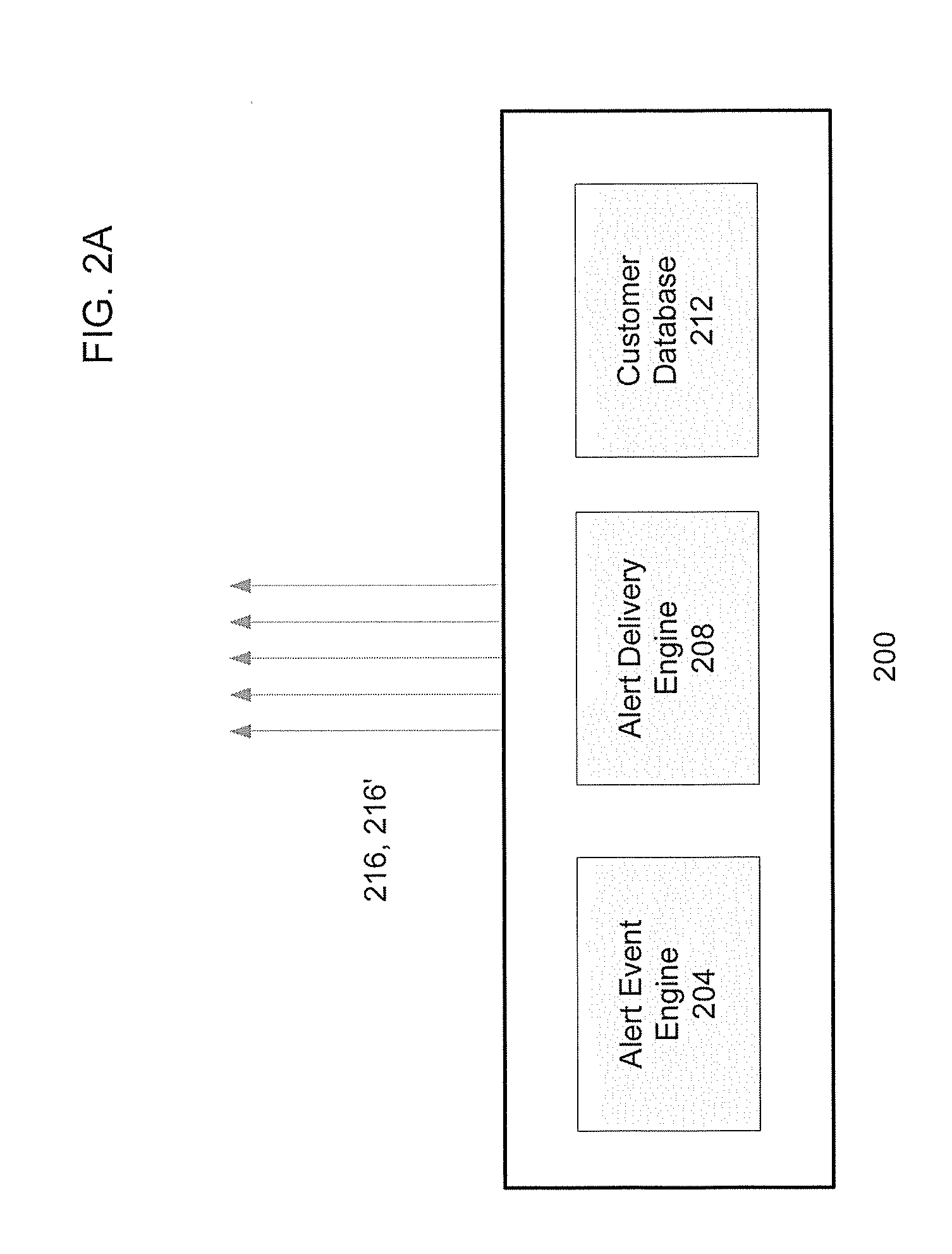

Alert Optimization System and Method

ActiveUS20130293363A1Optimize timingSignalling system detailsTransmissionDirect responseOptimization system

Systems and methods are disclosed for providing alerts to one or more customers at an optimized time and communication channel based on at least customer preferences, transactions, activities, usage patterns, and other information; and for allowing customers to directly respond and communicate feedback to alerts that are provided to complete various account actions, including to “snooze” one or more alerts.

Owner:JPMORGAN CHASE BANK NA

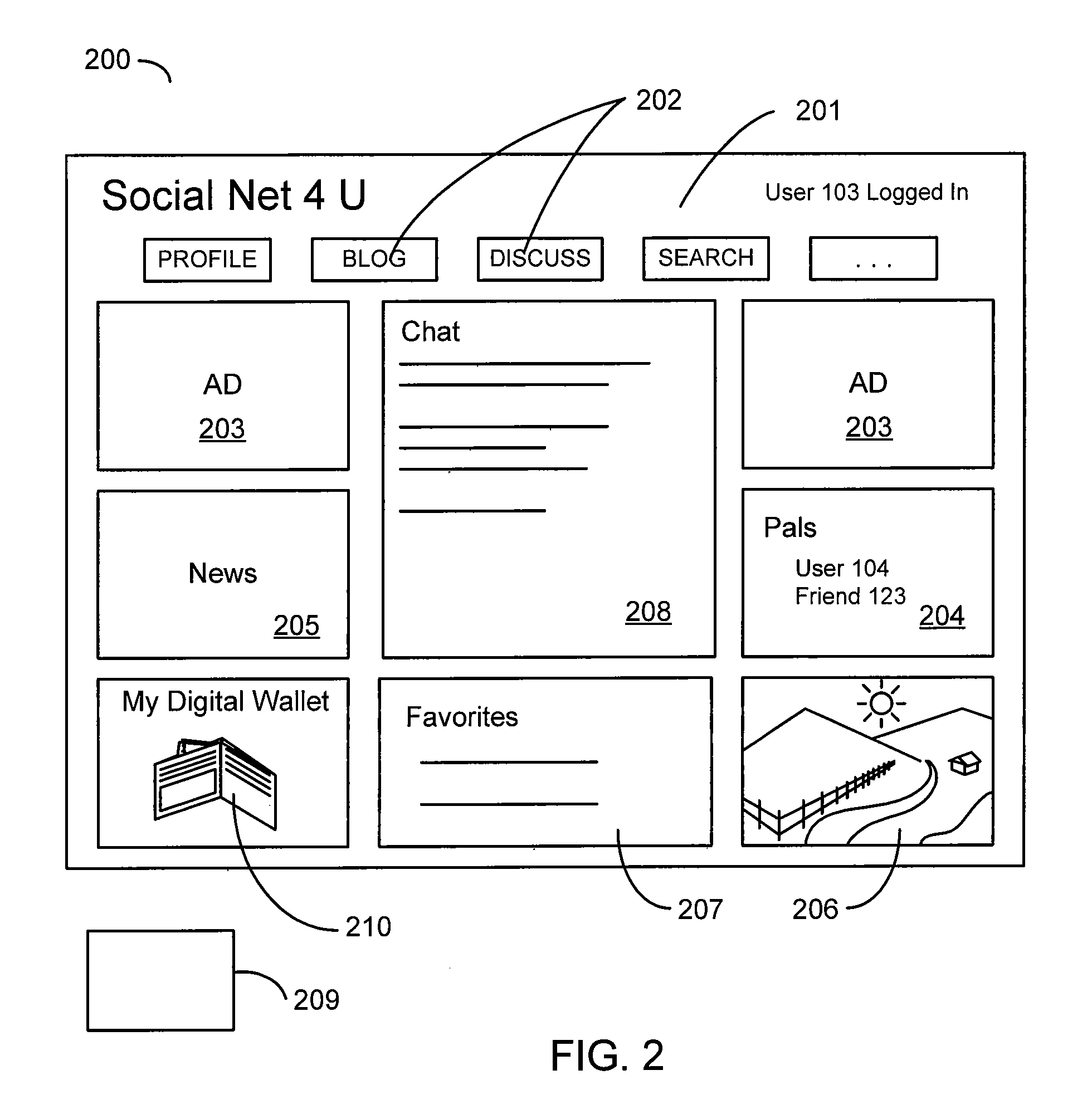

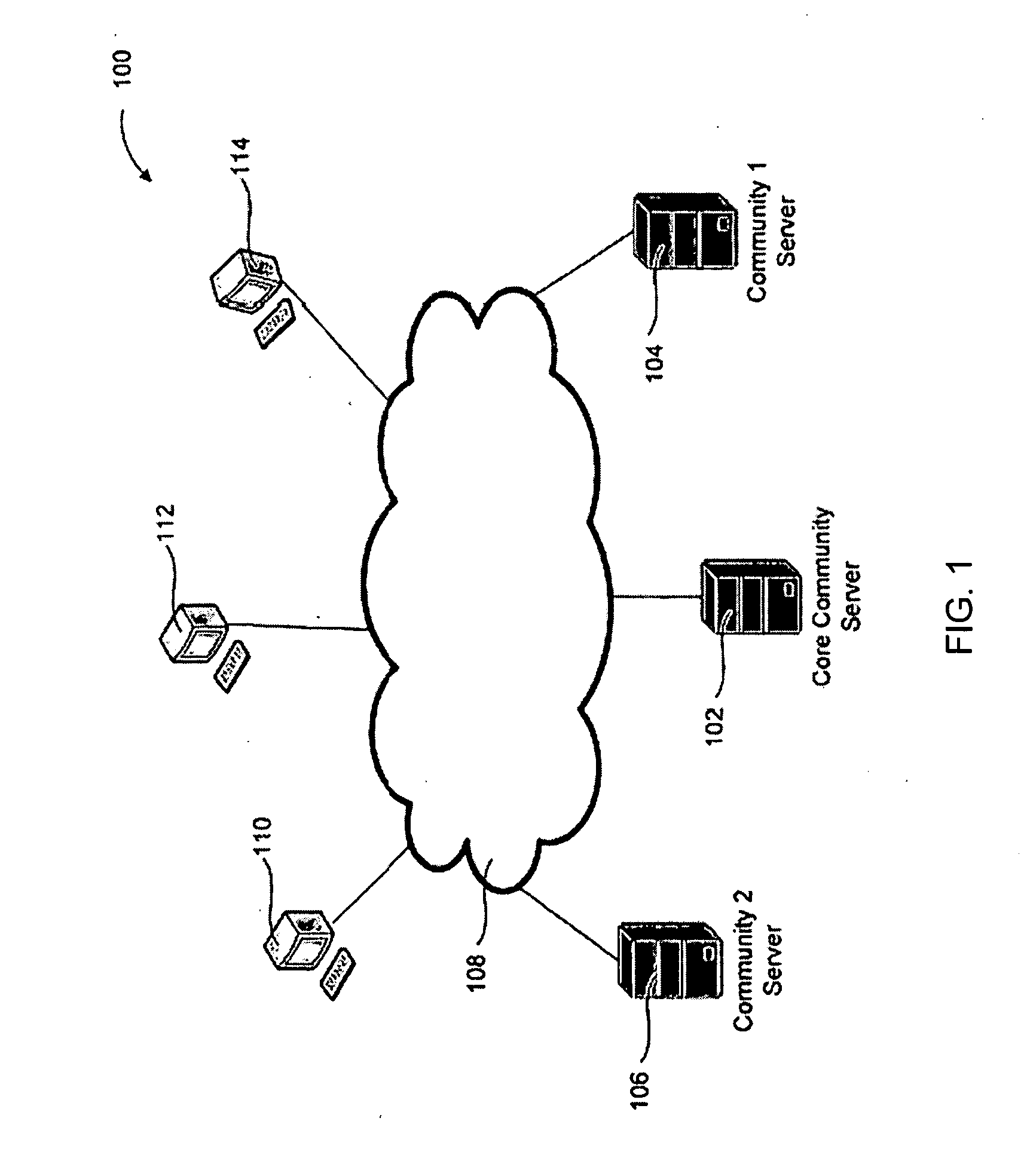

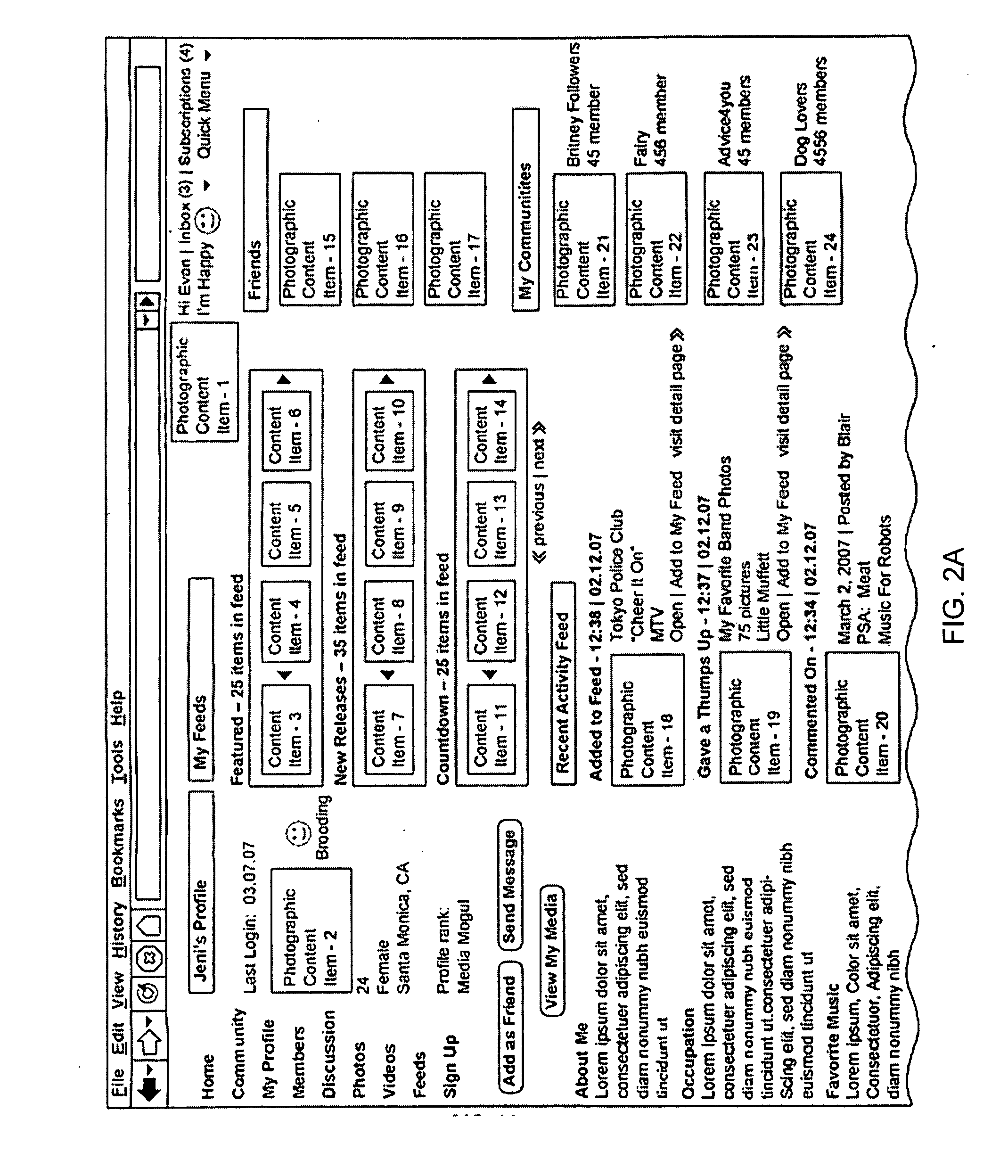

System for creating a social-networking online community

ActiveUS20090271247A1Reduce operating costsImprove experienceComplete banking machinesVoting apparatusSocial webOnline community

A system and method are provided for creating a social-networking community and enabling the social-networking community to interoperate with other social-networking communities within a network of social-networking communities. The method includes creating a core profile that links a user member's identify to plurality of social-networking communities of the network. The system enables user identity information, content, and friend information to be shared across social-networking communities of the network. The system also enables community content to be shared and tracked across social-networking communities of the network.

Owner:VIACOM INTERNATIONAL

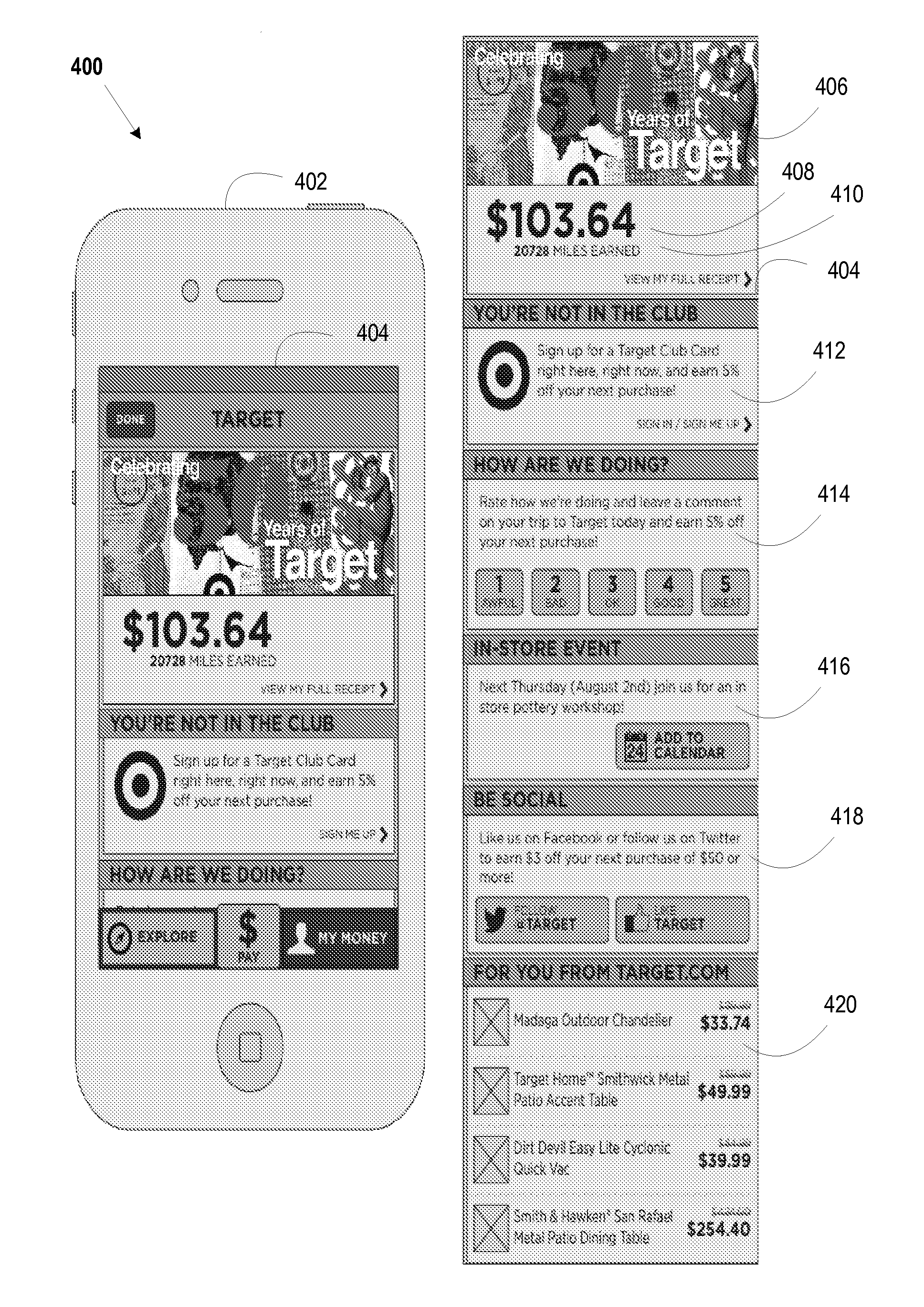

System and method for providing a mobile wallet shopping companion application

A system and method in accordance with example embodiments may include systems and methods for providing a mobile wallet shopping companion application. In an example embodiment, a method for providing a mobile wallet shopping companion application includes, receiving, via a network, confirmation of a transaction using a financial account; receiving, via a network, data relating to both the financial account and a customer associated with the financial account; and transmitting, via a network, processing the data relating to the financial account and the customer associated with the financial account in order to create a tailored offer and / or targeted data for the customer.

Owner:CAPITAL ONE SERVICES

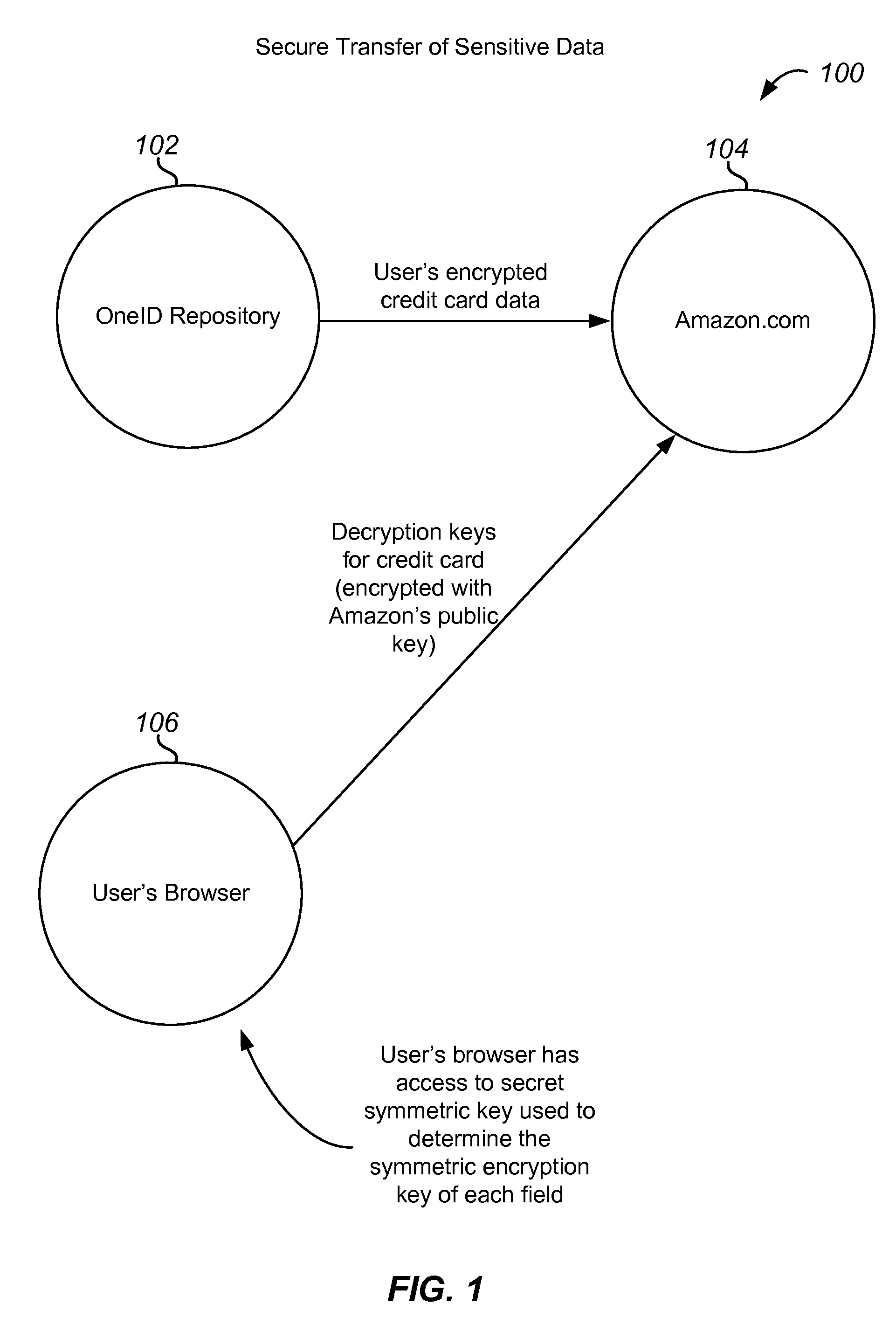

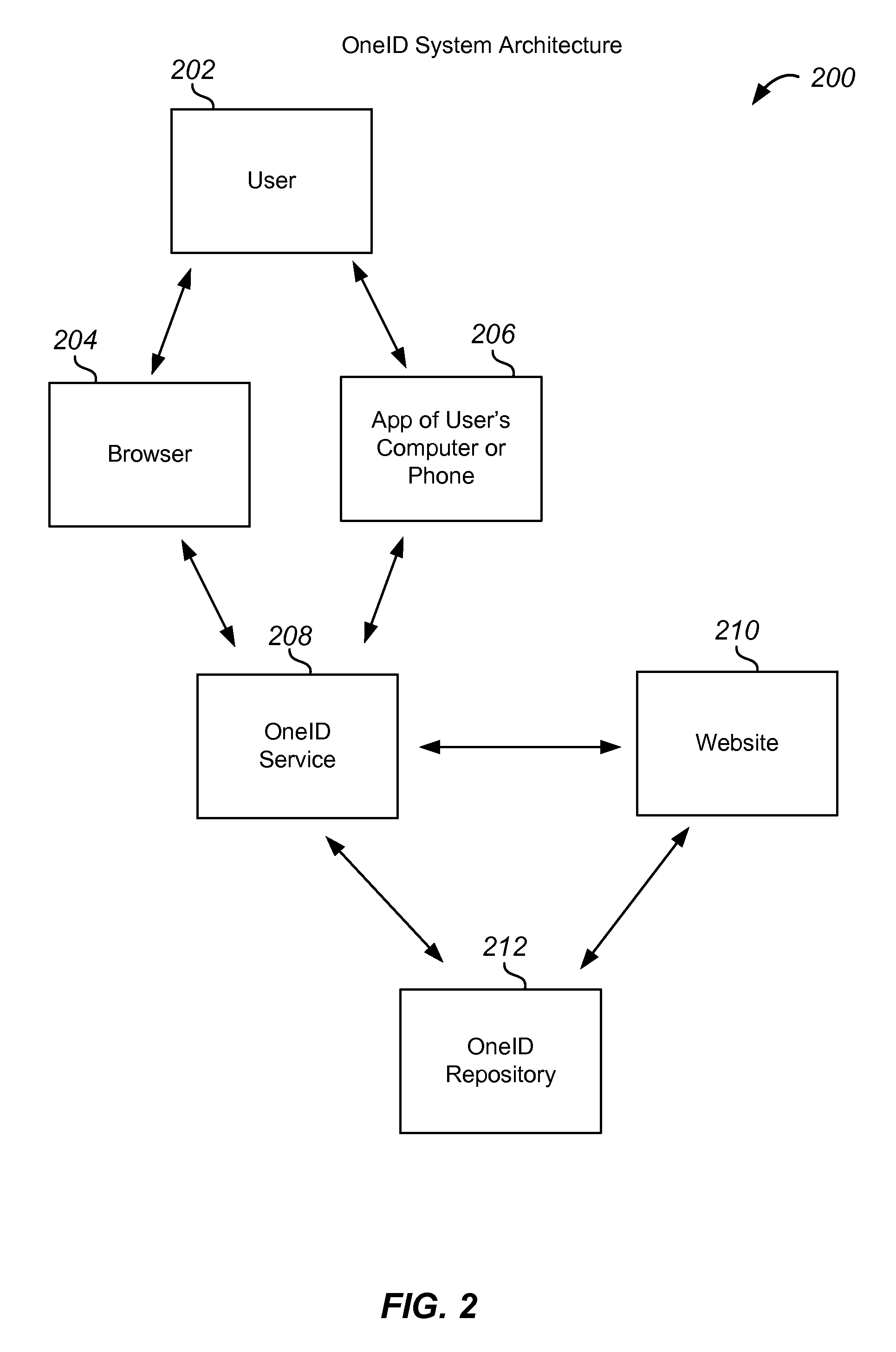

Method and system for fully encrypted repository

ActiveUS20120324242A1Safe storageFinanceUnauthorized memory use protectionComputer hardwareEncryption

According to an embodiment of the present invention, a method for using information in conjunction with a data repository includes encrypting data associated with the information with an encryption key, sending at least the encrypted data to the data repository, and possibly deleting the information. The method also includes receiving a request for the information from a remote device, and sending a request for the encrypted data to the data repository. The method further includes receiving the encrypted data from the data repository, decrypting the encrypted data using the encryption key, and sending the information to the remote device.

Owner:NEUSTAR

Enforcing policies in wireless communication using exchanged identities

ActiveUS20100061294A1Facilitating exchange of information and transactionShort capabilityDiscounts/incentivesServices signallingWi-FiComputer network

Techniques for facilitating the exchange of information and transactions between two entities associated with two wireless devices when the devices are in close proximity to each other. A first device uses a first short range wireless capability to detect an identifier transmitted from a second device in proximity, ideally using existing radio capabilities such as Bluetooth (IEEE802.15.1-2002) or Wi-Fi (IEEE802.11). The detected identifier, being associated with the device, is also associated with an entity. Rather than directly exchanging application data flow between the two devices using the short range wireless capability, a second wireless capability allows for one or more of the devices to communicate with a central server via the internet, and perform the exchange of application data flow. By using a central server to draw on stored information and content associated with the entities the server can broker the exchange of information between the entities and the devices.

Owner:PROXICOM WIRELESS

Hot wallet for holding bitcoin

A system and method for transaction bitcoin is described. Bitcoin can be sent to an email address. No miner's fee is paid by a host computer system. Hot wallet functionality is provided that transfers values of some Bitcoin addresses to a vault for purposes of security. A private key of a Bitcoin address of the vault is split and distributed to keep the vault secure. Instant exchange allows for merchants and customers to lock in a local currency price. A vault has multiple email addresses to authorize a transfer of bitcoin out of the vault. User can opt to have private keys stored in locations that are under their control. A tip button rewards content creators for their efforts. A bitcoin exchange allows for users to set prices that they are willing to sell or buy bitcoin and execute such trades.

Owner:COINBASE

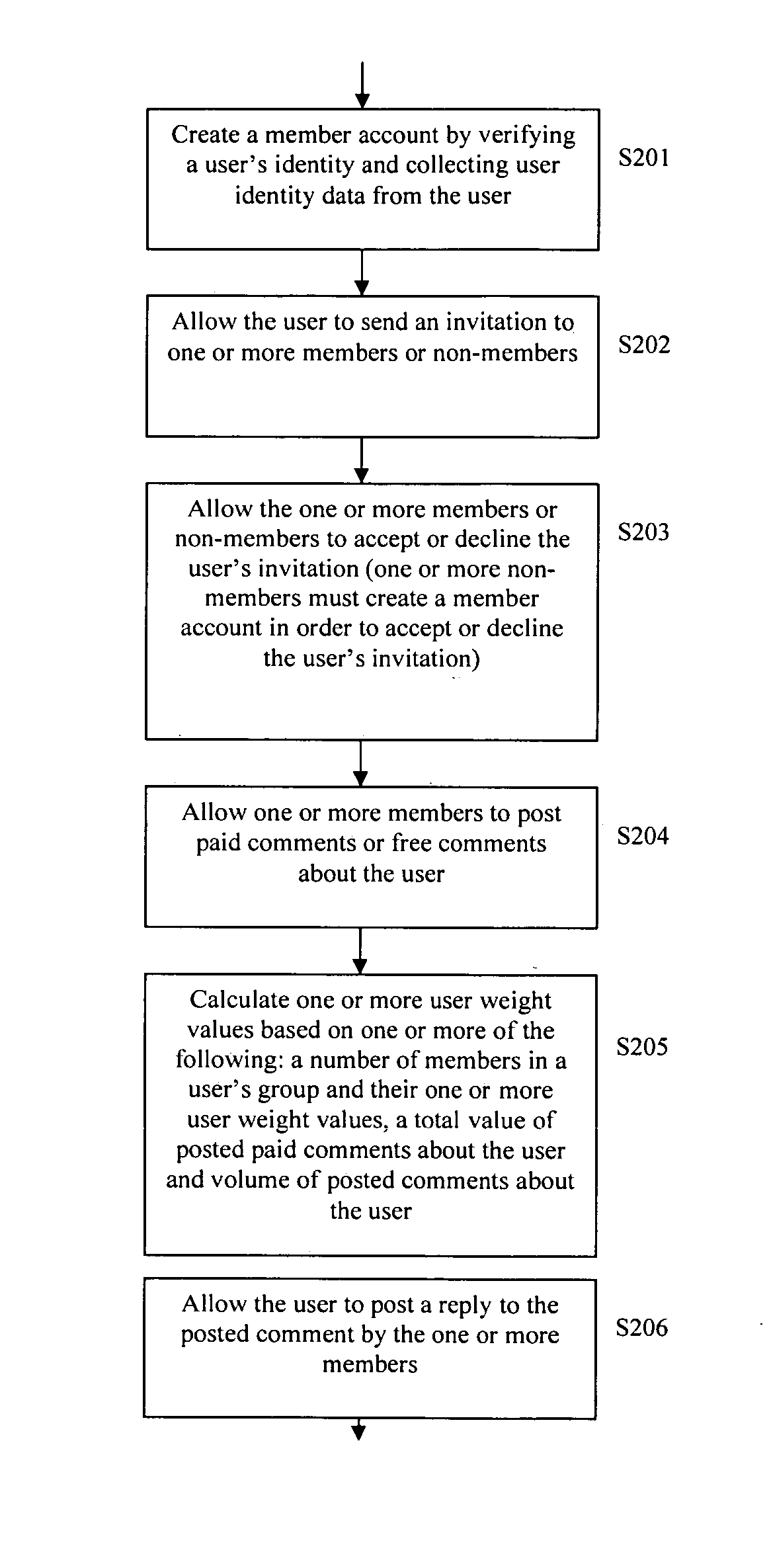

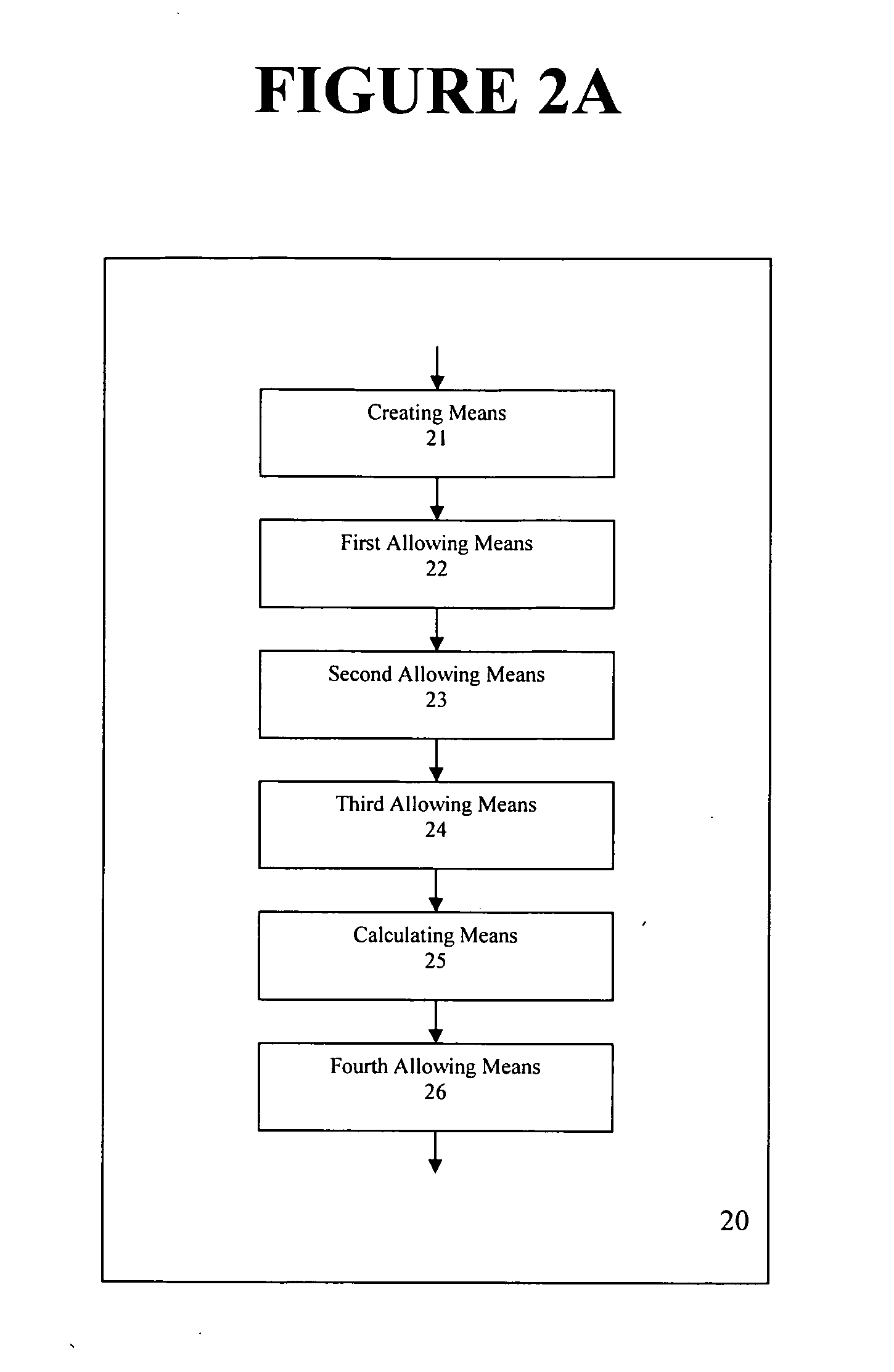

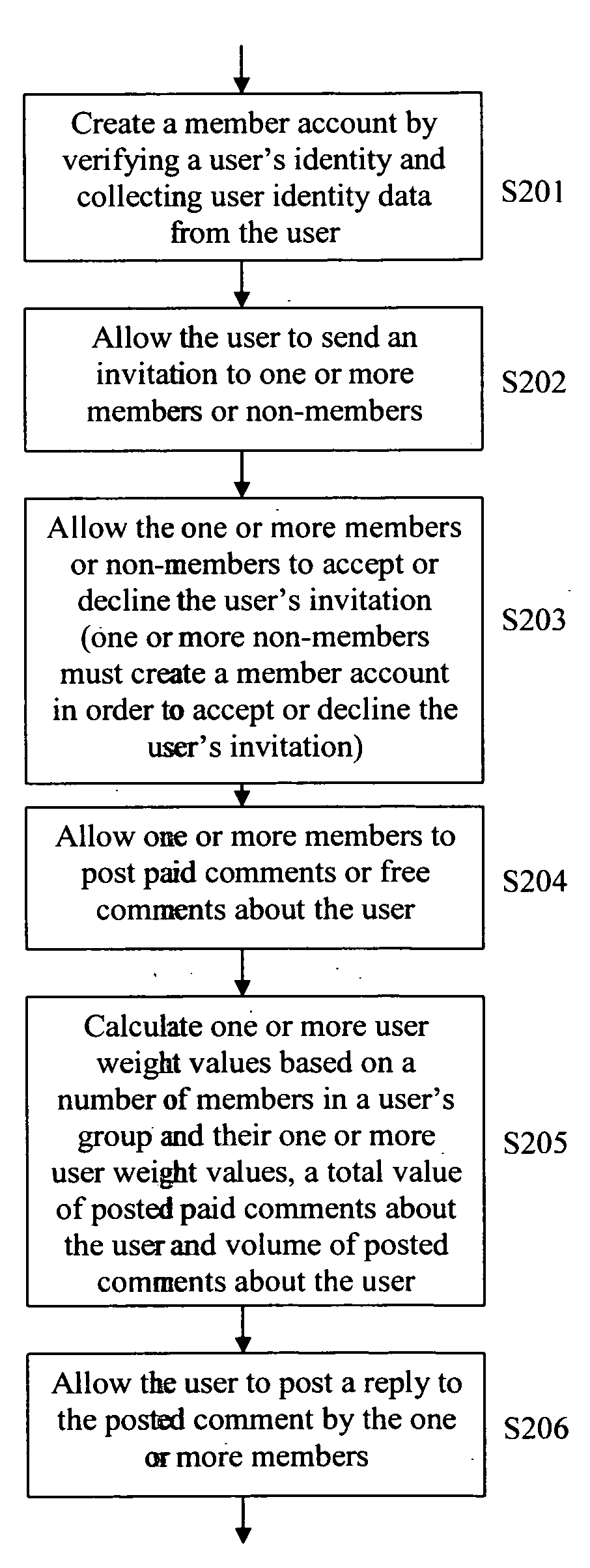

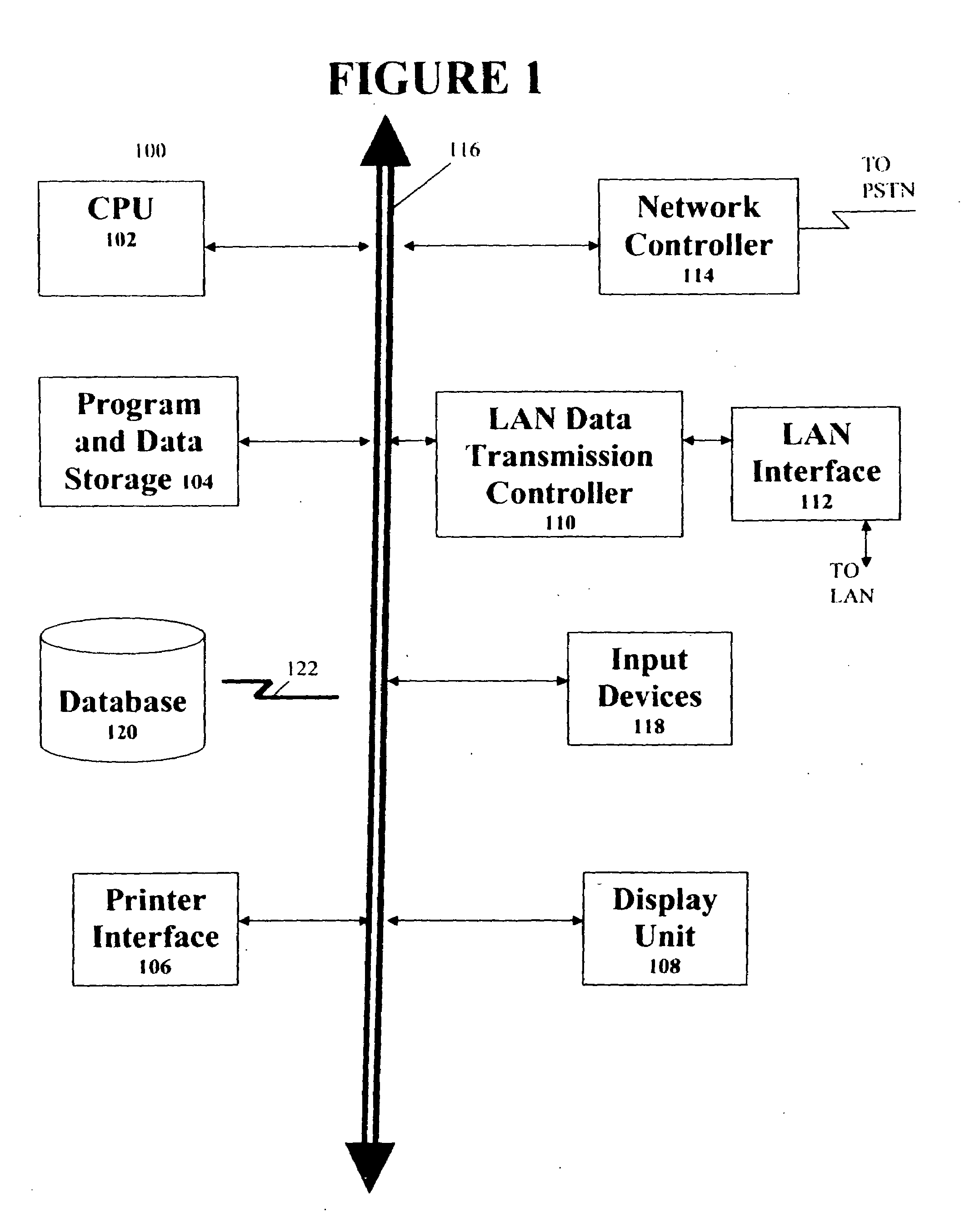

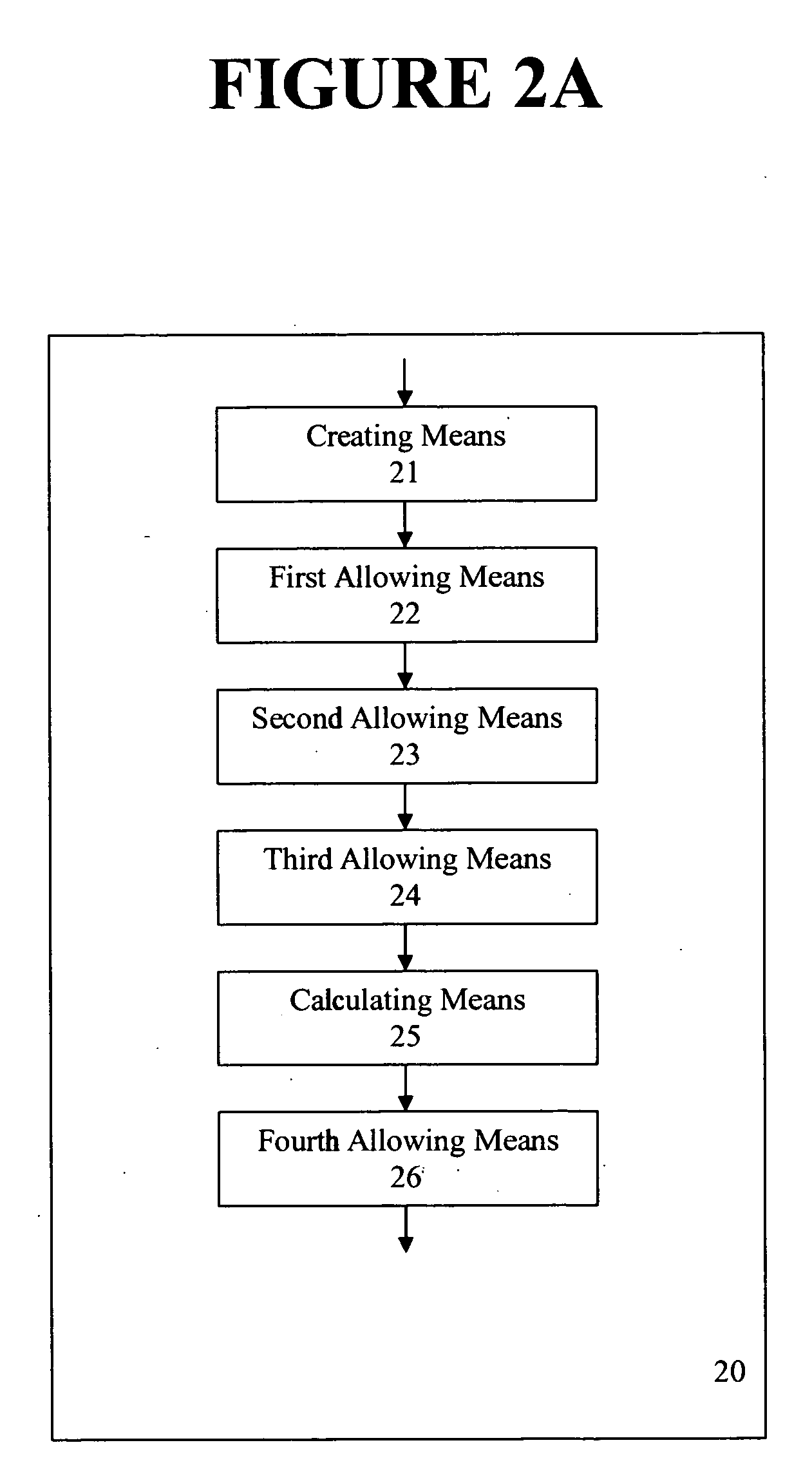

Method and apparatus for collecting and storing information about individuals in a social network

Method and apparatus for collecting and storing information about individuals in a social network. A member account is created by verifying a user's identity and collecting user identity data from the user. The user sends an invitation to one or more members or non-members. The one or more members or non-members can accept or decline the user's invitation. If the one or more non-members accept or decline, they must create a member account. The one or more members post paid comments or free comments about the user and one or more user weight values are calculated based on one or more of the following: a number of members in a user's group and their one or more user weight values, a total value of posted paid comments about the user and volume of posted comments about the user. The user can post a reply to the posted comment by the one or more members.

Owner:STAY AWAKE INC

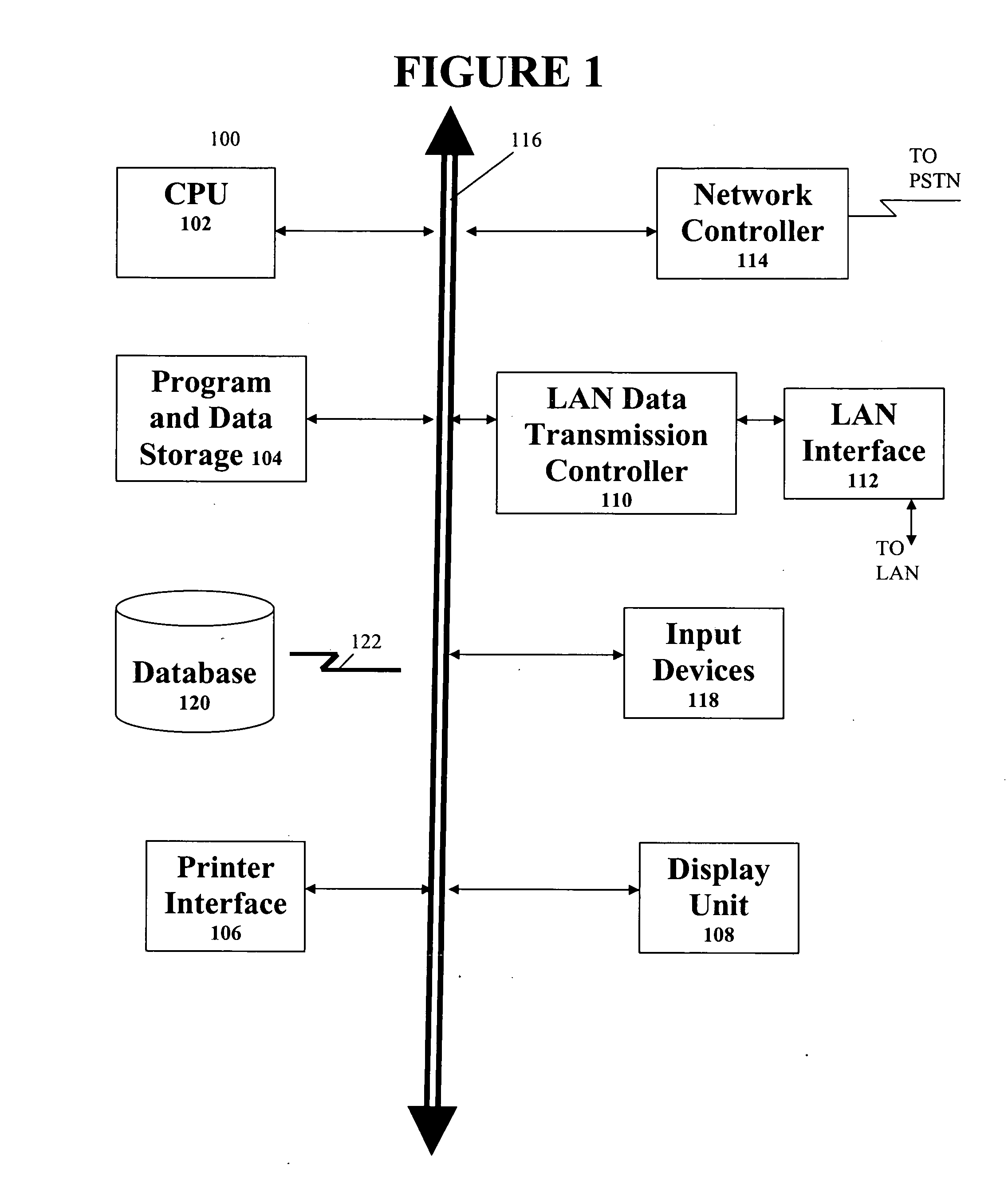

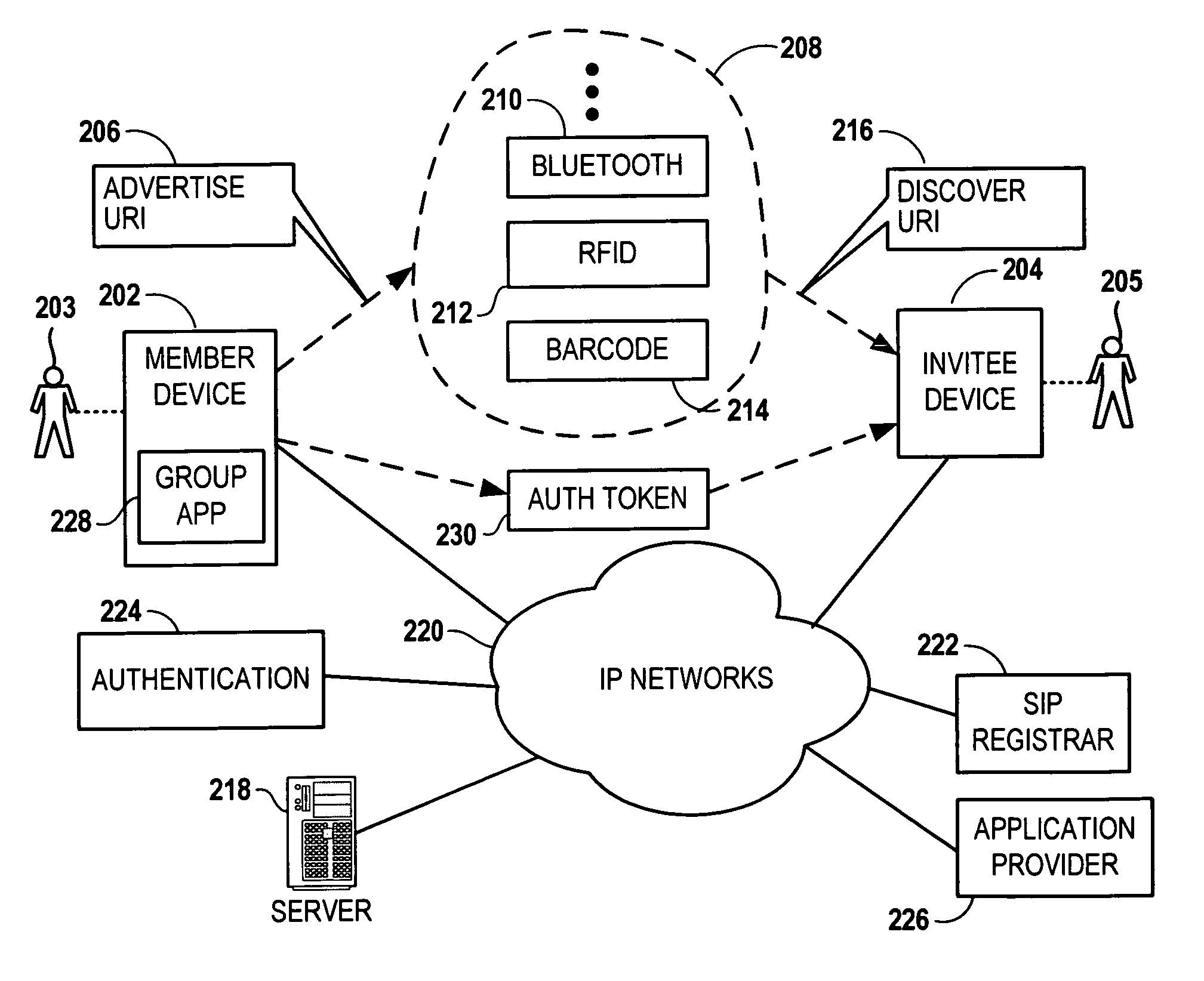

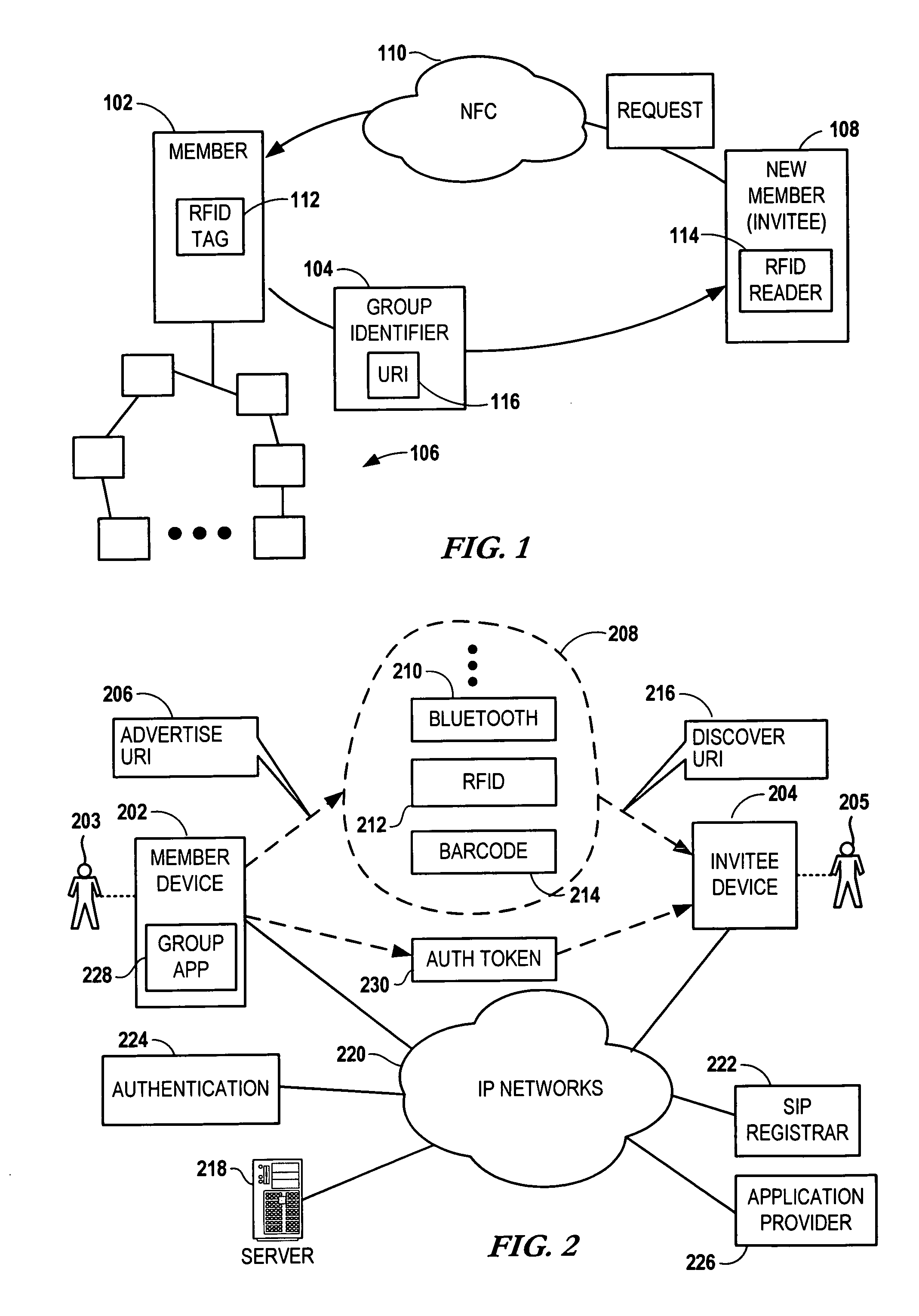

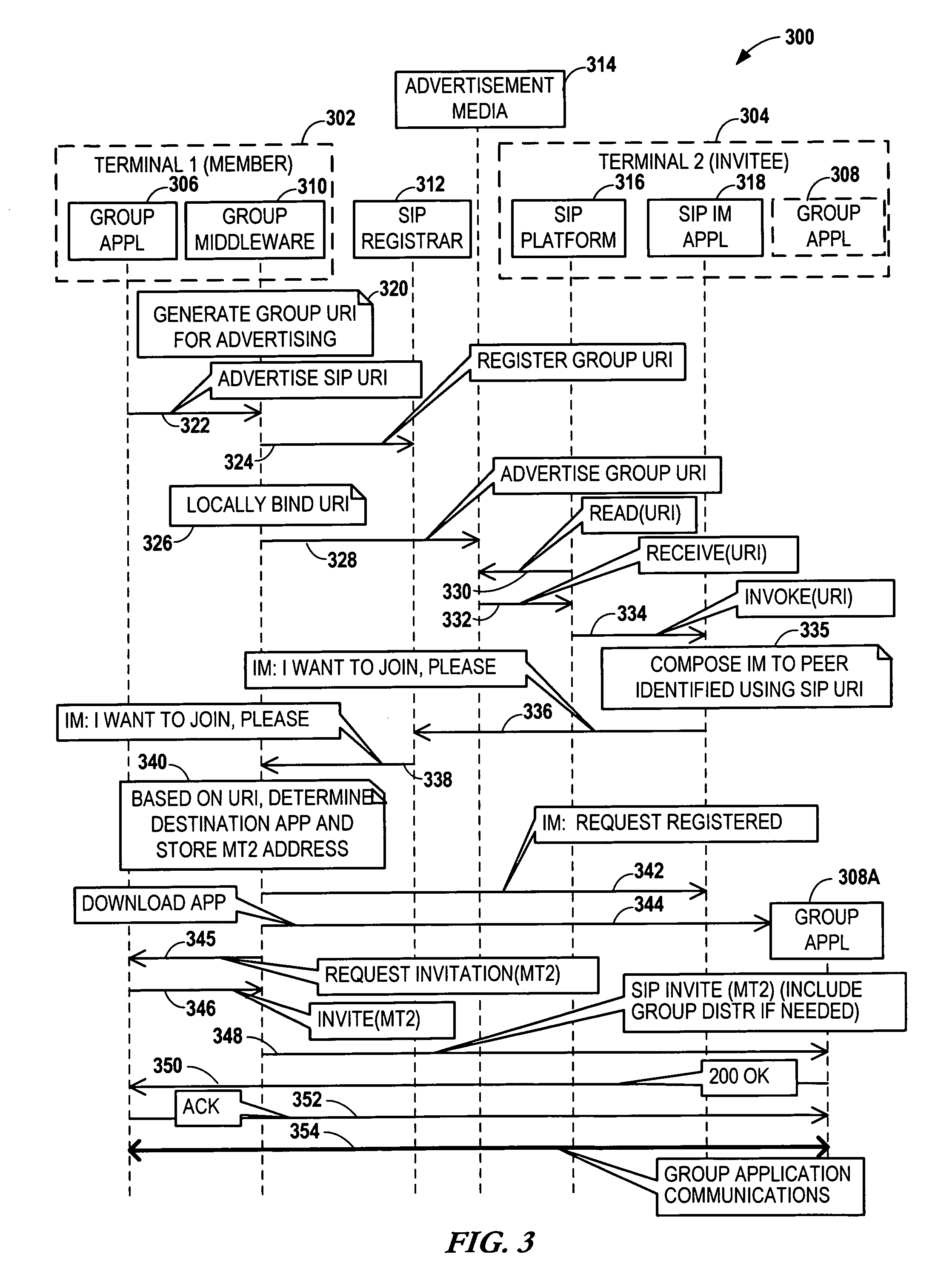

Group formation using mobile computing devices

InactiveUS20070019616A1Facilitate network communicationEasy to sendBroadcast service distributionNetwork connectionsNetwork communicationCommunication device

A computer-implemented method of joining an exclusive network communications group of data communications device users. A network location usable for requesting admission to the network communications group is advertised. A request message is sent from an invitee's communication device to the network location to request joining the network communications group. The invitee's communication device receives an acceptance message from at least one member of the group in response to the request message. The invitee's communication device receives a group application capable of executing via the invitee's communication device in response to the acceptance message. The network communications group is joined via the group application executing on the invitee's communication device.

Owner:NOKIA SOLUTIONS & NETWORKS OY

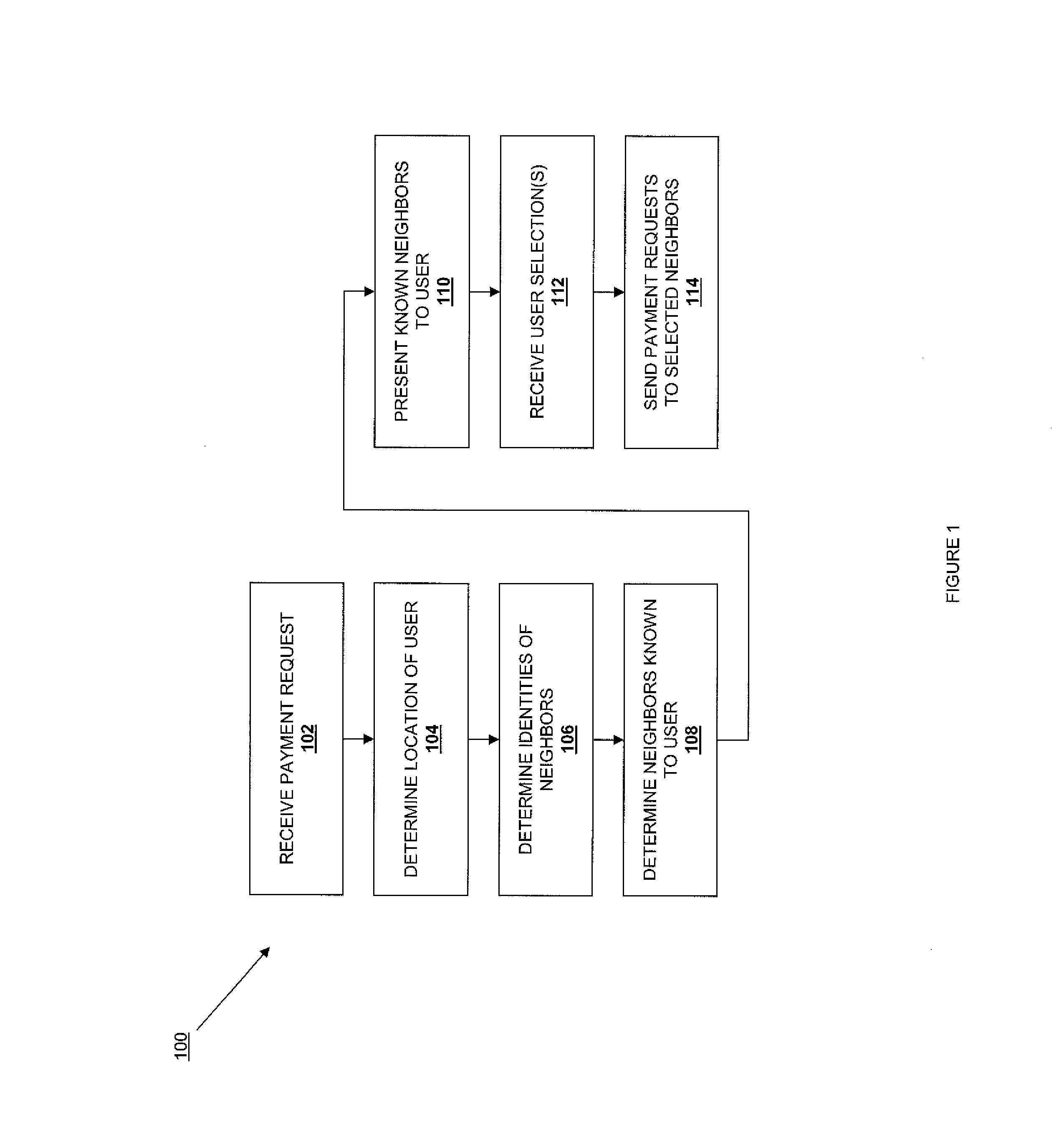

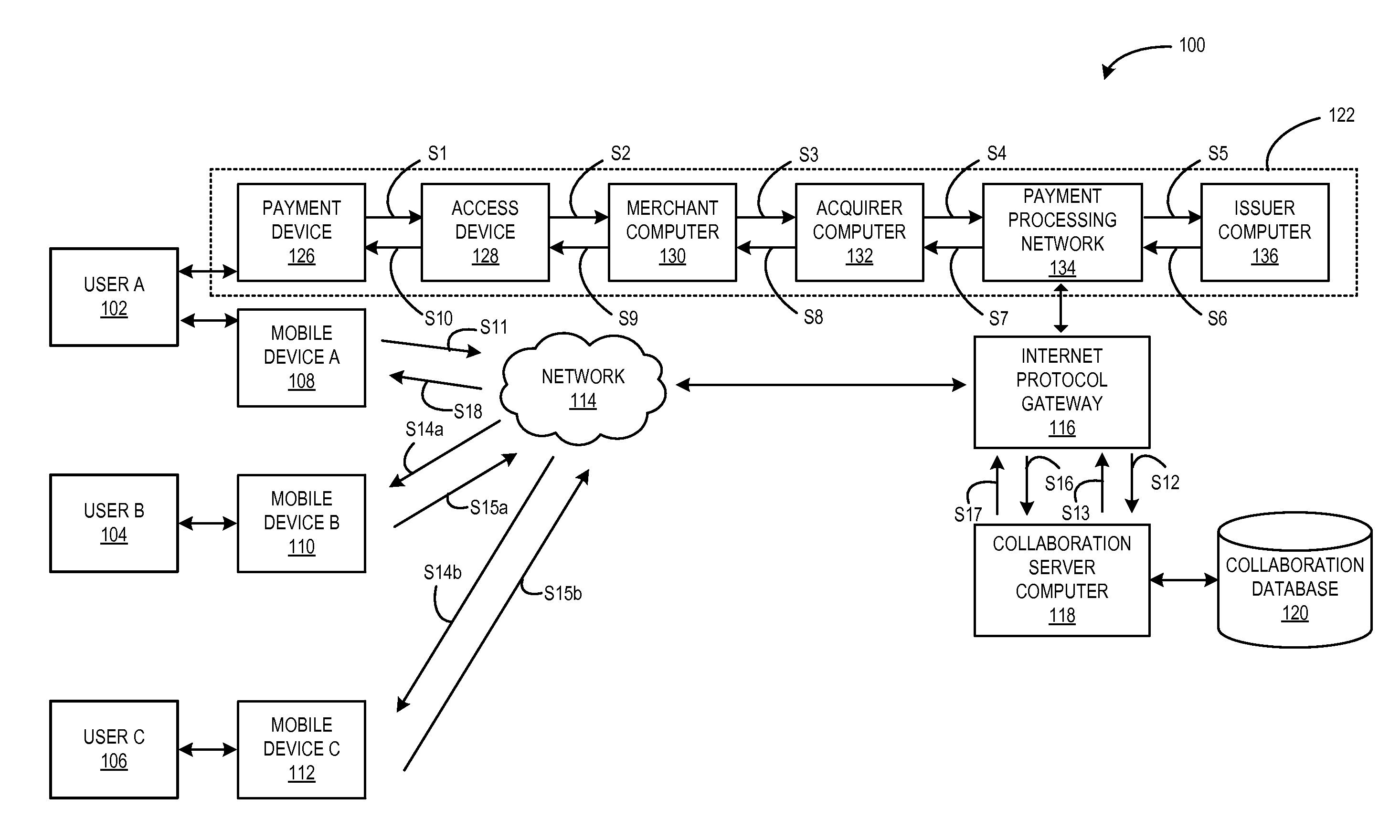

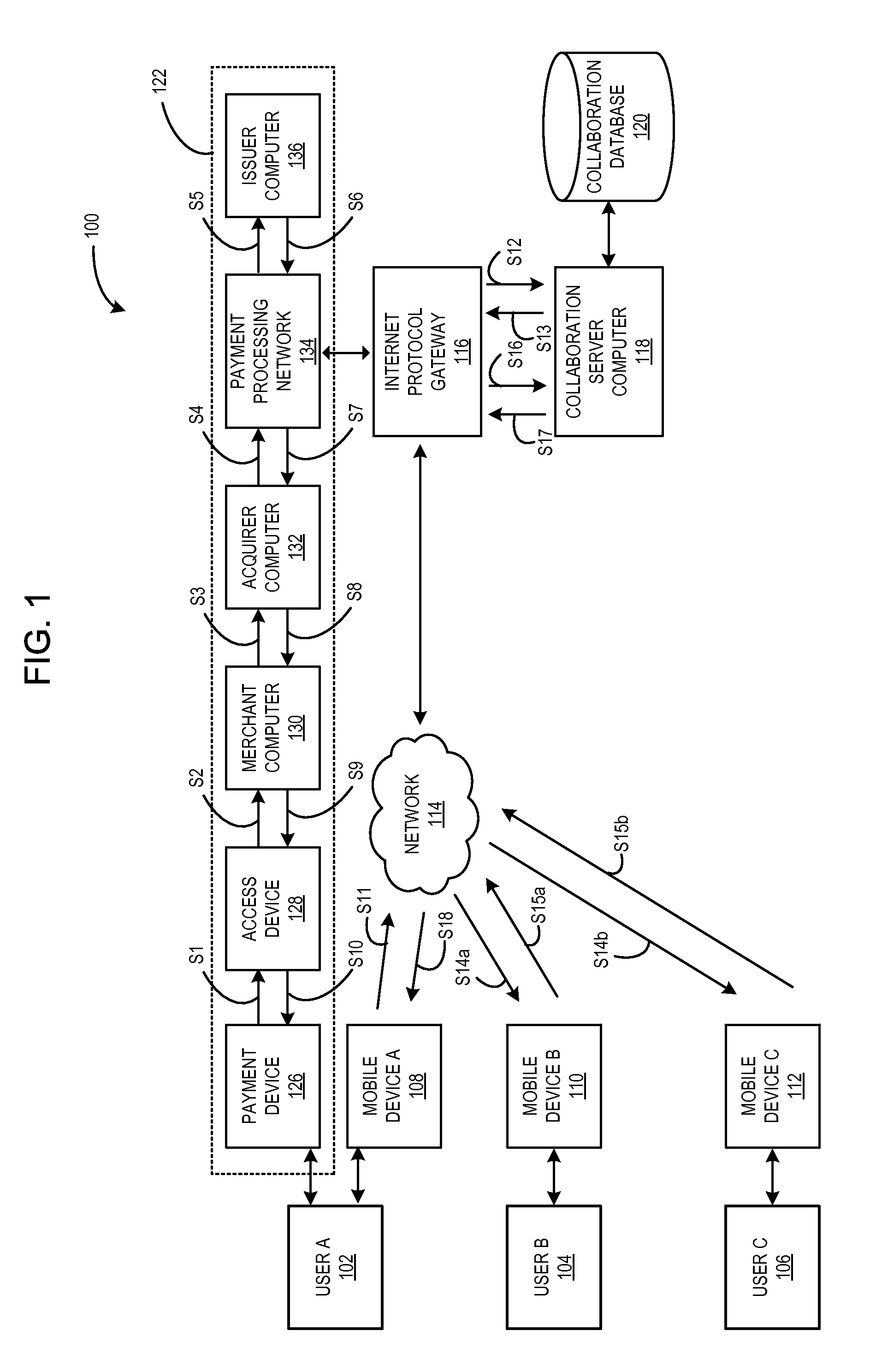

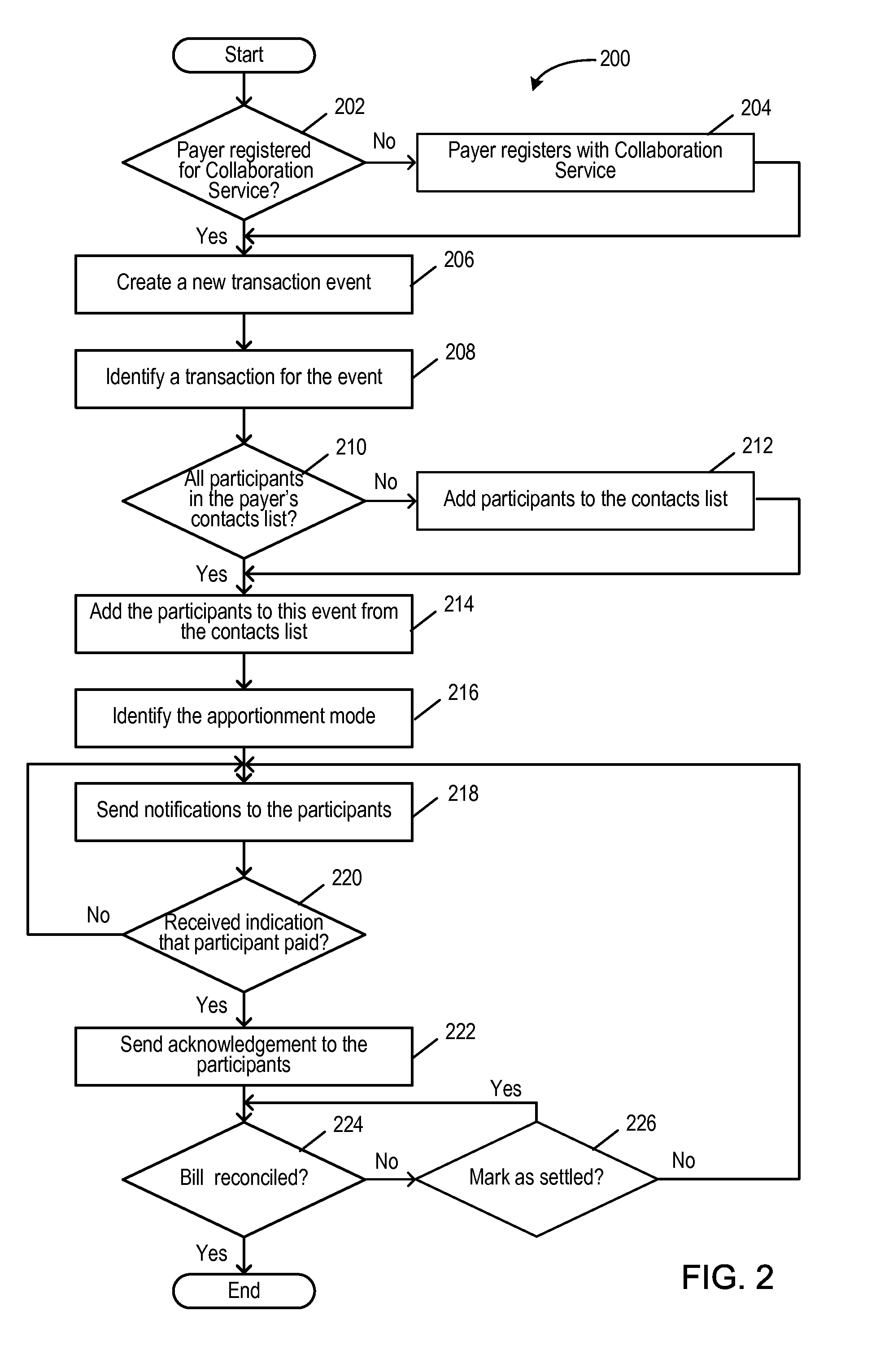

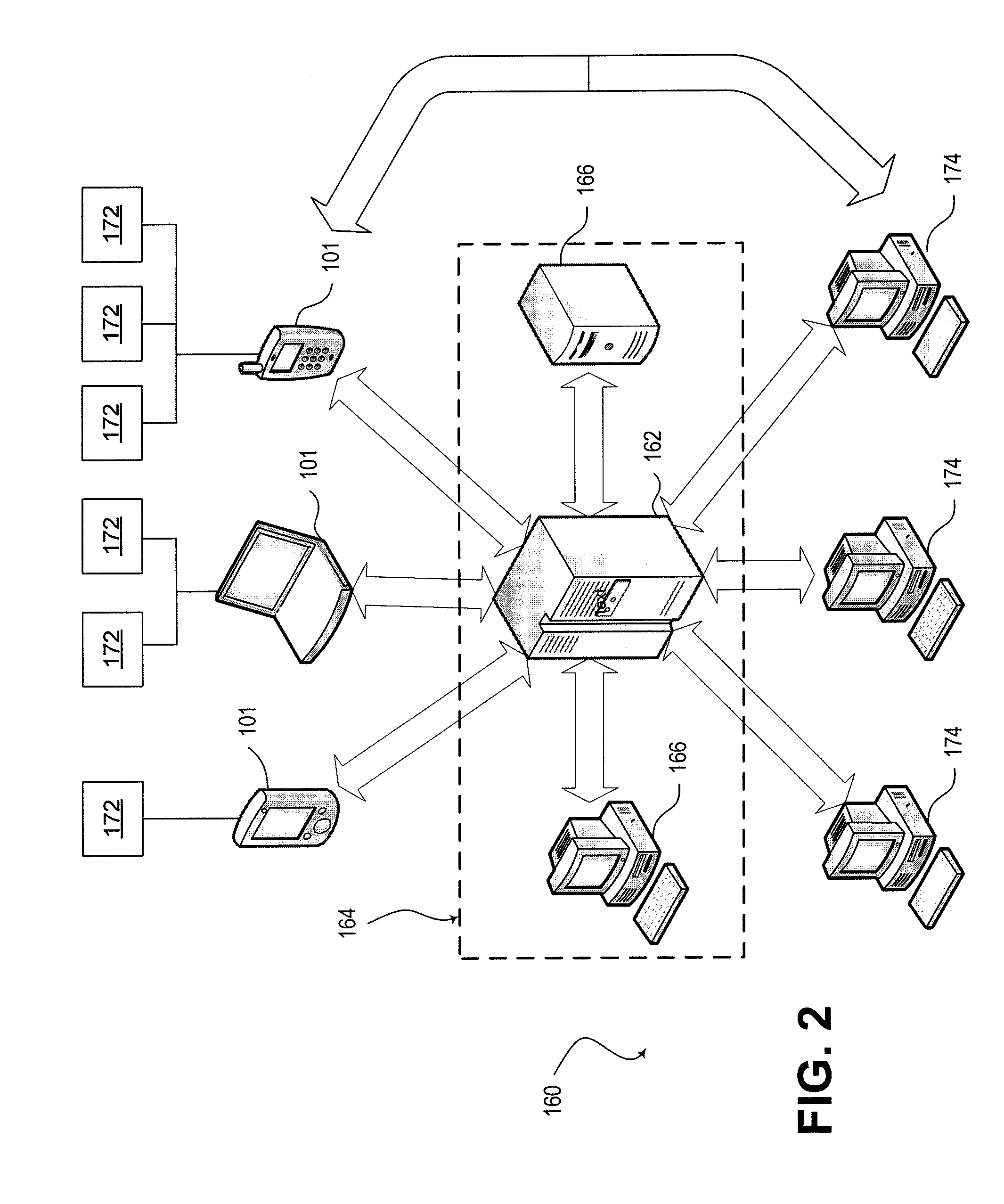

Systems and Methods of Aggregating Split Payments Using a Settlement Ecosystem

Systems, apparatuses and methods for enabling a group of people to share the cost of an event, such as a meal, the purchase of a gift, or the rental of a car. Embodiments of the invention provide the tools needed to enable a group to participate in a shared event or activity, where one of the participants pays for the event or activity using their payment device and the other members of the group pay their portion of the cost to the participant who made the payment. Embodiments of the invention provide an ecosystem where a person can pay for an event, goods, or services using a single payment device (such as a credit or debit card) and then settle the amounts owed to them by other members of a group using the tools provided by the invention.

Owner:VISA INT SERVICE ASSOC

Authentication methods for use in financial transactions and information banking

ActiveUS8028896B2Complete banking machinesHand manipulated computer devicesBiometric dataFinancial transaction

A method for conducting a financial transaction can be used by a person using a mobile device to conduct the transaction. The mobile device receives information related to the person that can be used for authentication purposes, such as a PIN or biometric data. The mobile device then authenticates the person by verifying the information received. If the person is authenticated, the transaction is completed using the mobile device, and if the person is not authenticated, the transaction is prevented.

Owner:BANK OF AMERICA CORP

Methods for encouraging charitable social networking

A method of encouraging charitable donations by individuals who are members of a social network is disclosed. A user creates a member account by supplying user identity data from the user and creates a campaign, wherein the created campaign is associated with one or more charities and a financial goal. The user sends invitation to one or more members or non-members and the one or more members or non-members may accept or decline the user's invitation. The one or more members are given the option to donate any amount of money to a charity to post comments about the user, where the monetary value of the donation is associated with the comments posted such that a higher amount donated represents a higher trustworthiness of the comments. The one or more members or non-members may support the campaign by donating money to the one or more charities to help reach the financial goal. One or more user weight values are calculated based at least on a total volume of members or non-members who support the campaign by donating money to the one or more charities and / or a total monetary value of the money donated by the one or more members or non-members, where the one or more user weight values represent reliability of a user's reputation.

Owner:STAY AWAKE INC

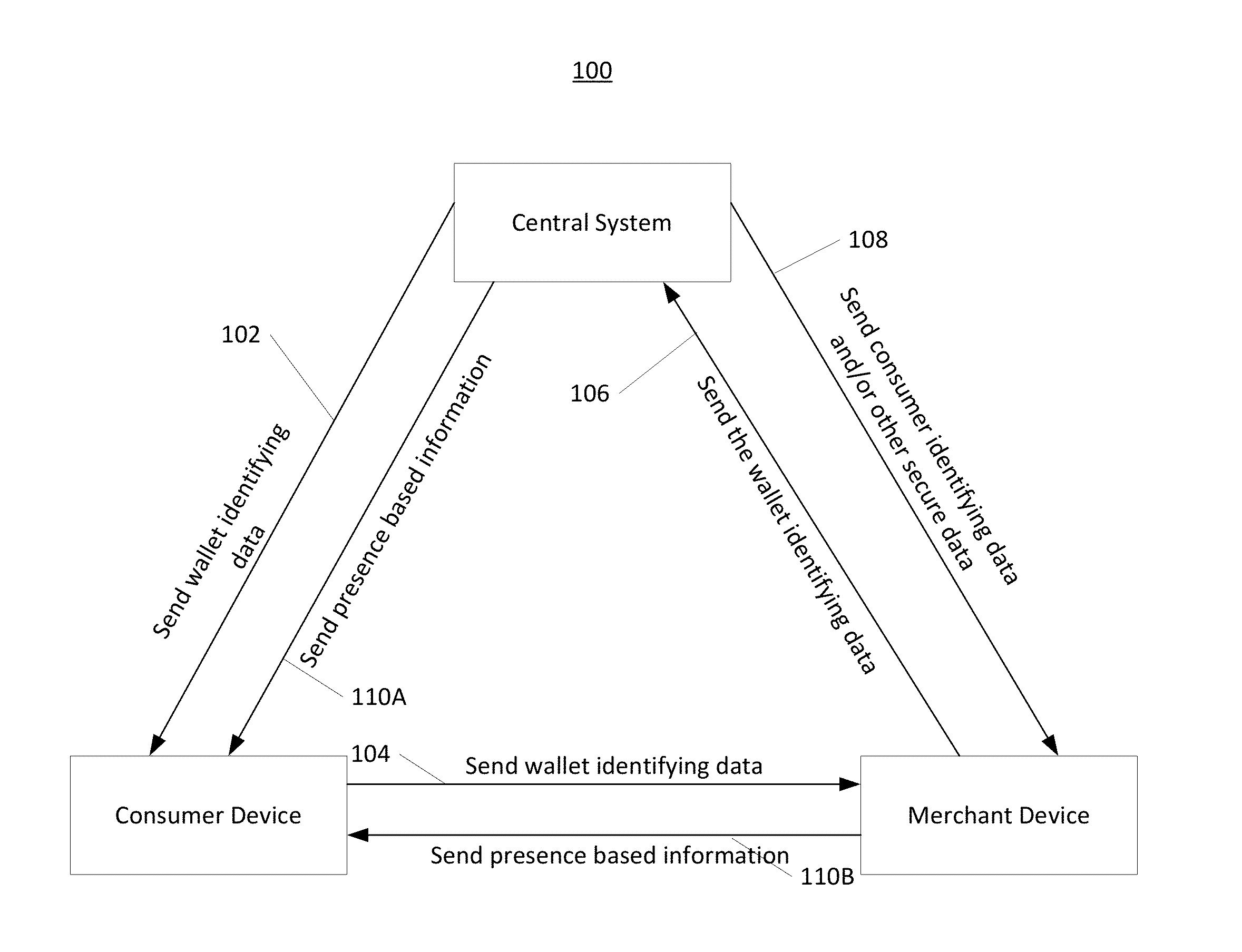

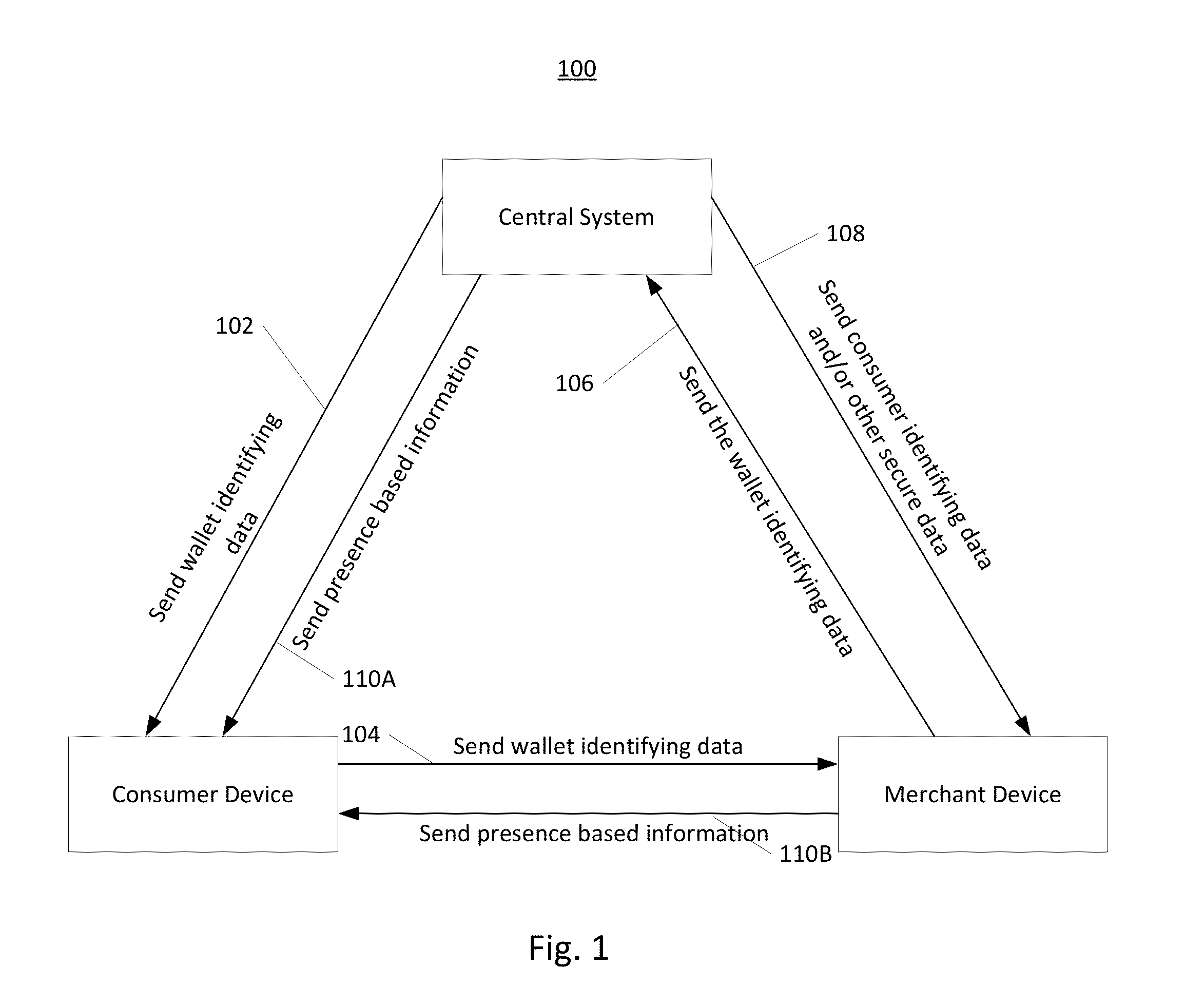

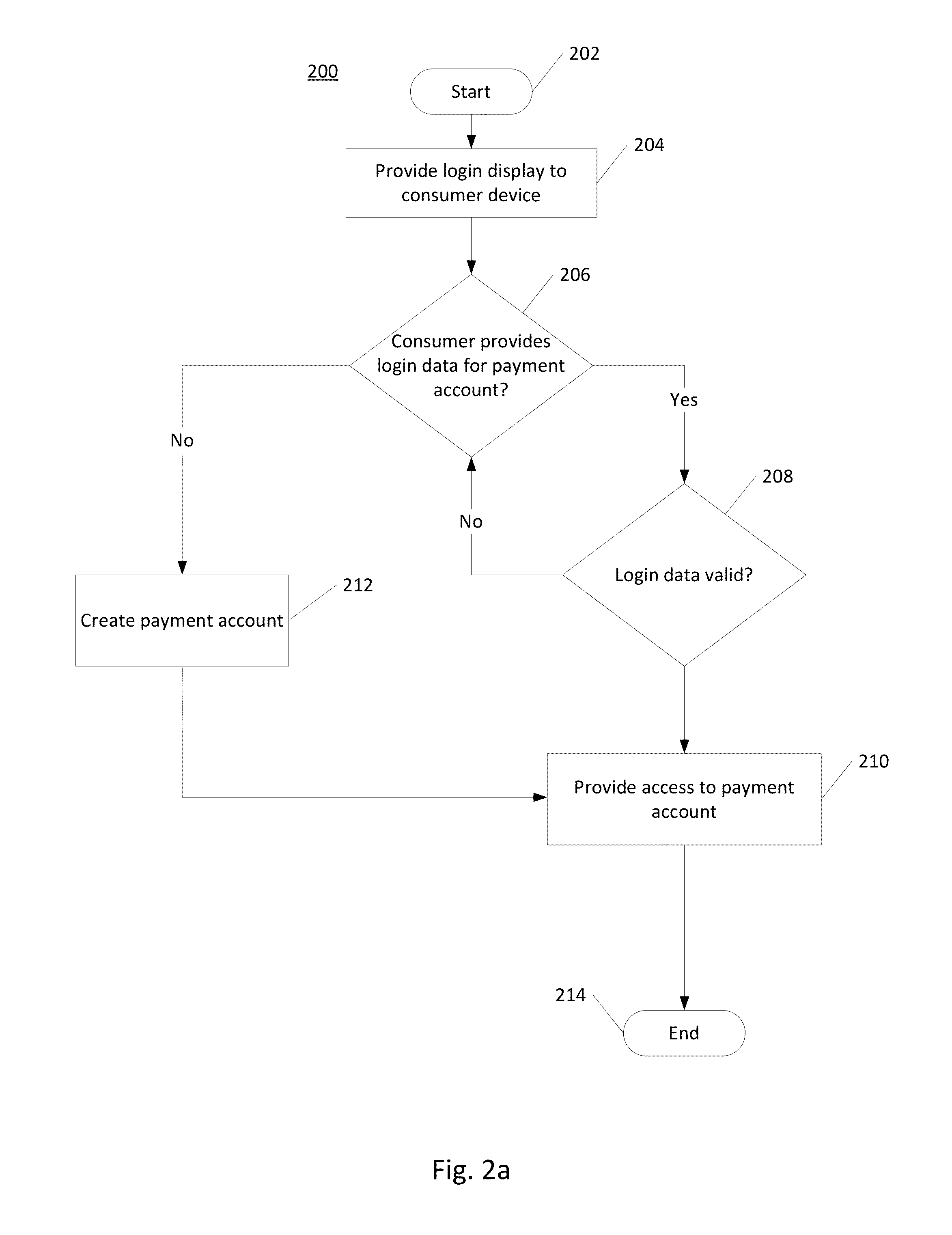

Consumer presence based deal offers

ActiveUS20140108108A1Easy to judgeFinanceProtocols using social networksVoucherFinancial transaction

Systems and related methods facilitating payments with a mobile device are discussed herein. Circuitry in a networked-based central system, which may be a promotional system or payment system, may be configured to receive payment information from a consumer device. The consumer device may include circuitry configured to receive wallet identifying data from the central system. The wallet identification data may be used to secure messages between the consumer device and another device, such as a merchant device, over a wireless link. In some embodiments, the consumer device may receive promotional offers, such as deal vouchers or rewards, and make payments to the other device via the wireless link.

Owner:GROUPON INC

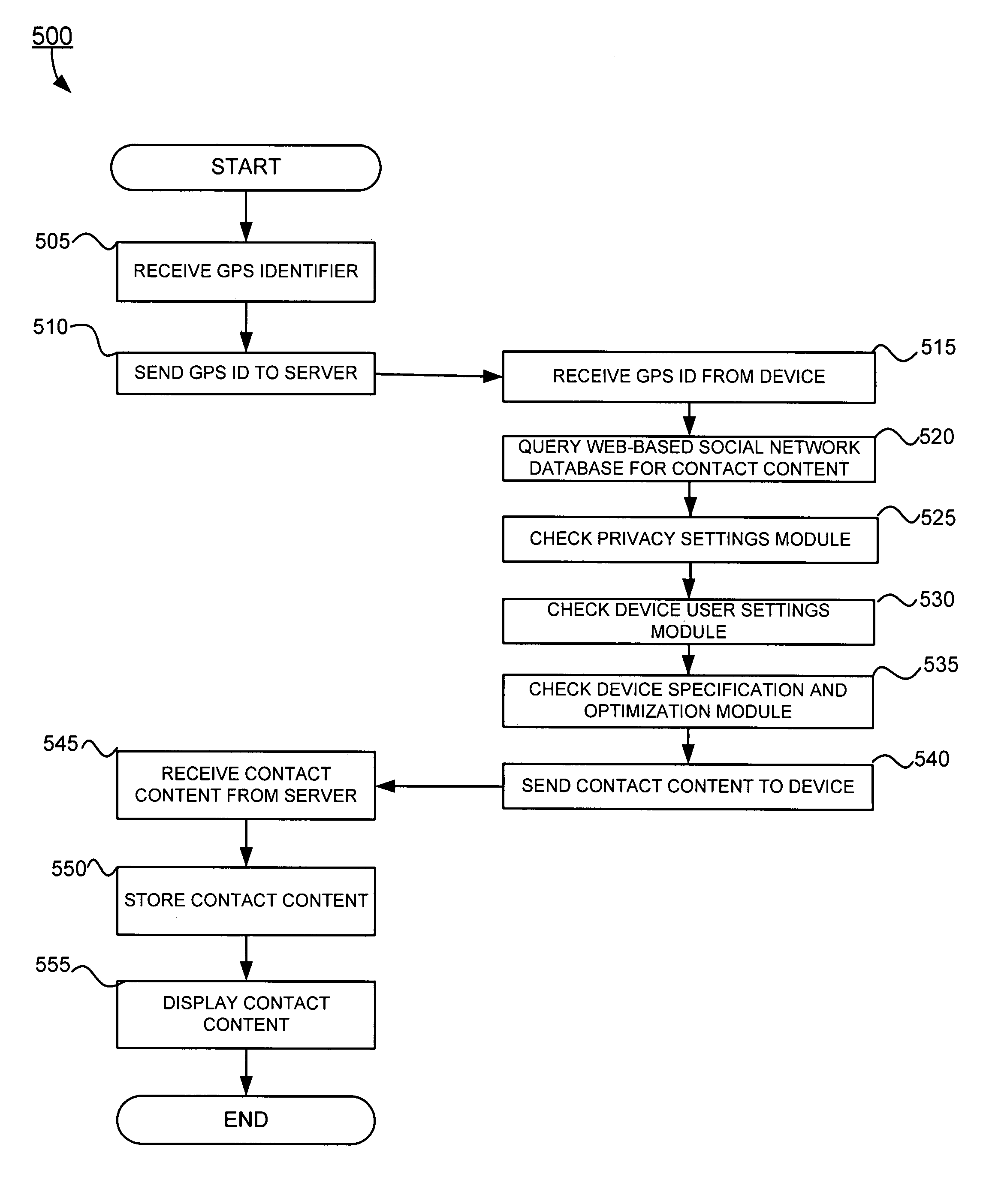

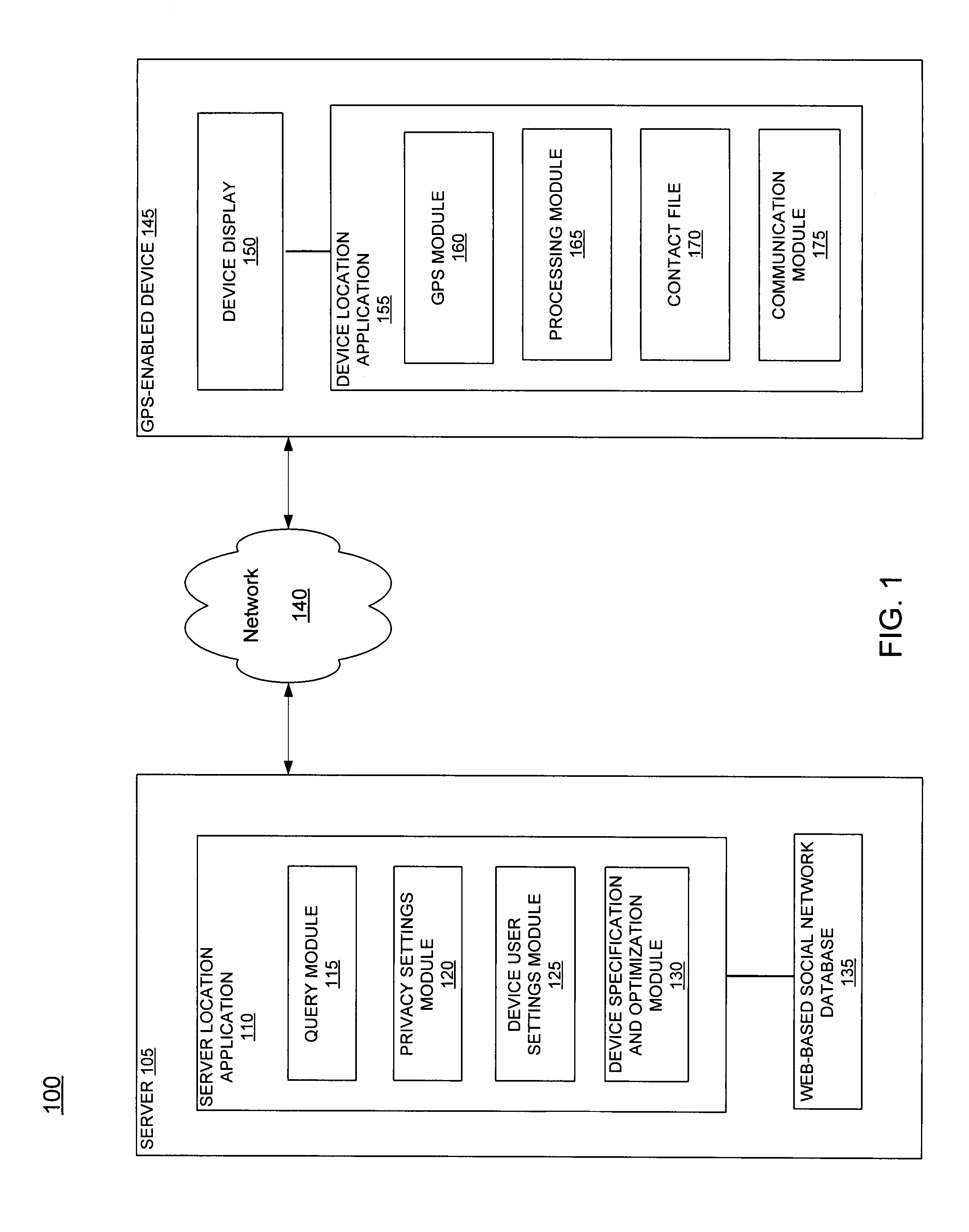

Systems and methods for automatically locating web-based social network members

ActiveUS7809805B2Digital data processing detailsInformation formatState dependentWeb based social networks

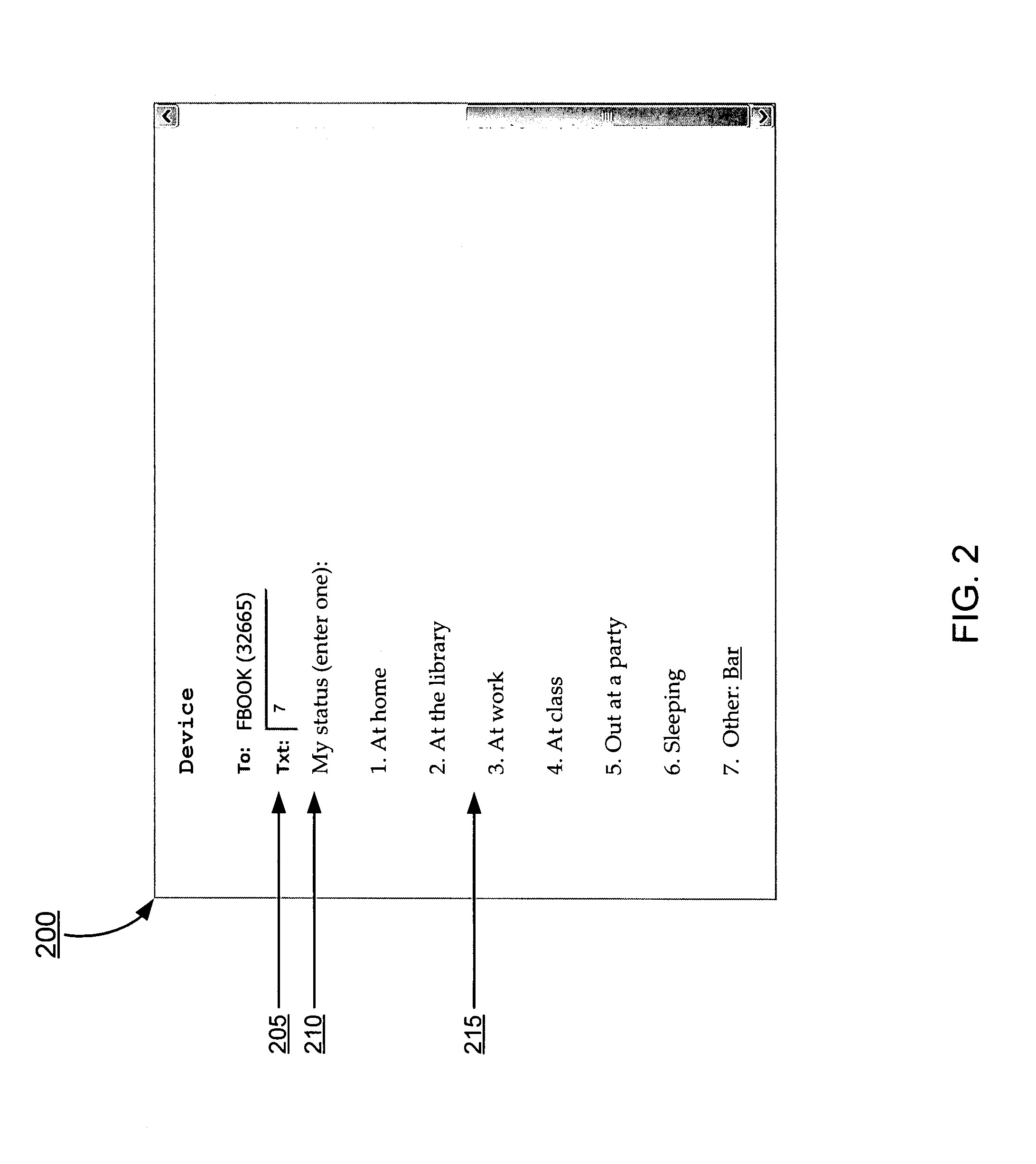

Systems and methods for automatically locating web-based social network members are provided. According to one embodiment, contact content including an associated GPS identifier and status for web-based social network members located at or near the same location automatically appears on a GPS-enabled device. A further exemplary system includes a GPS-enabled device configured to receive a GPS identifier and a status representing a location and a current state for a web-based social network member, a processing module that associates the received GPS-identifier and the received status, and a communications module that sends the associated GPS-identifier and status to a server comprising a web-based social network database. Contact content in a web-based social network database record in the web-based social network database is updated to include the associated GPS identifier and status for the web-based social network member.

Owner:META PLATFORMS INC

System and Method for Enhanced Transaction Authorization

ActiveUS20150142595A1Hand manipulated computer devicesBuying/selling/leasing transactionsThird partyInternet privacy

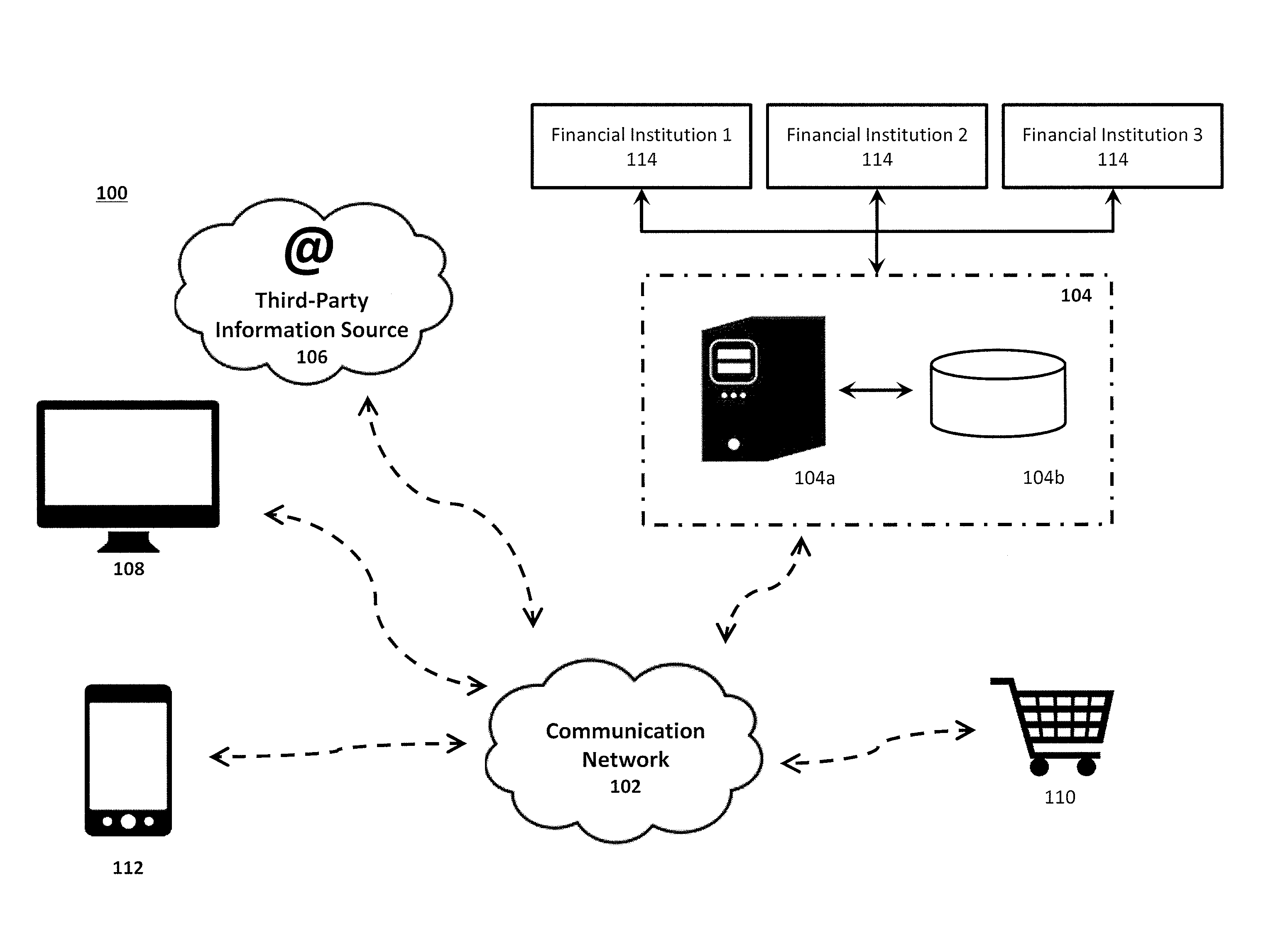

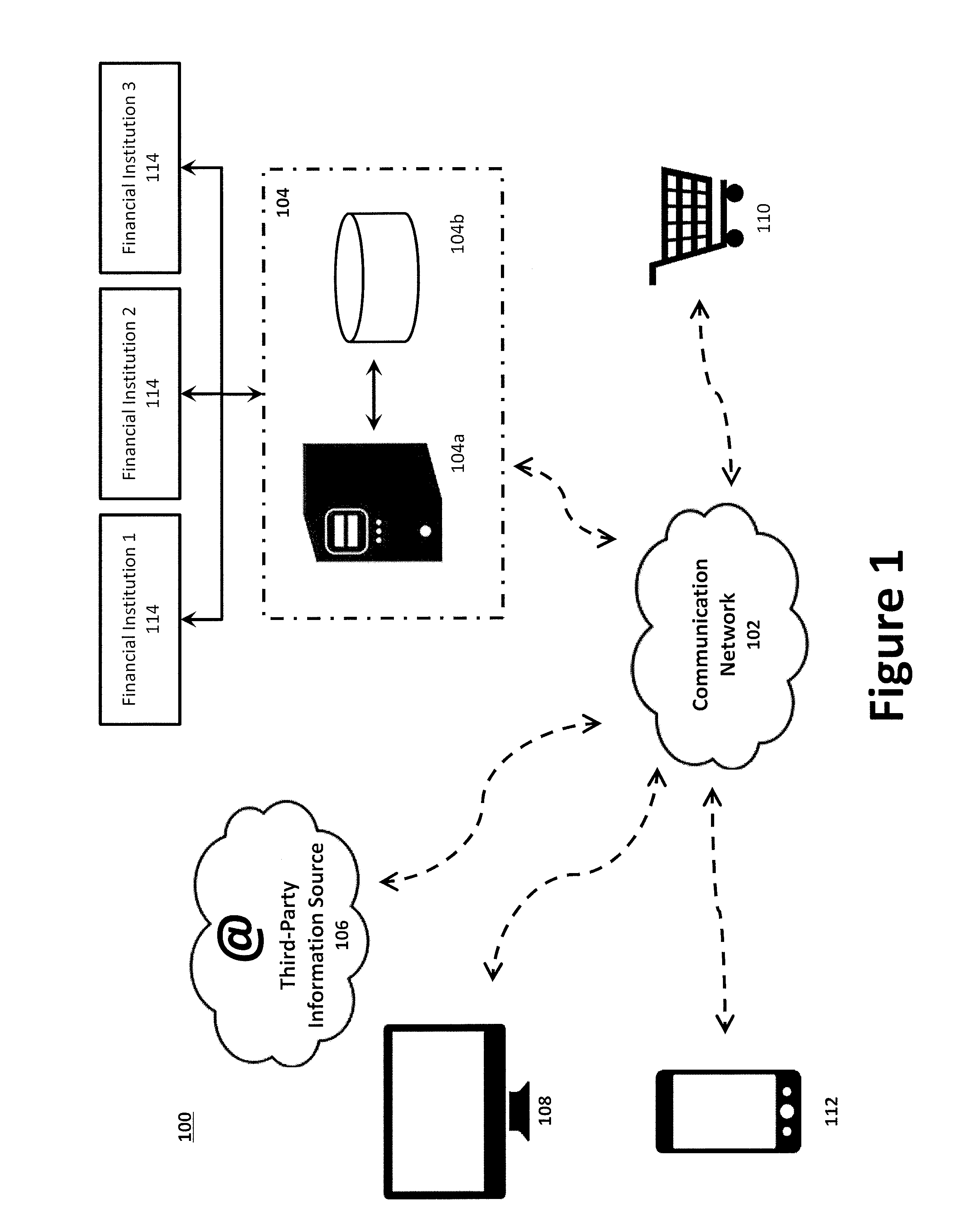

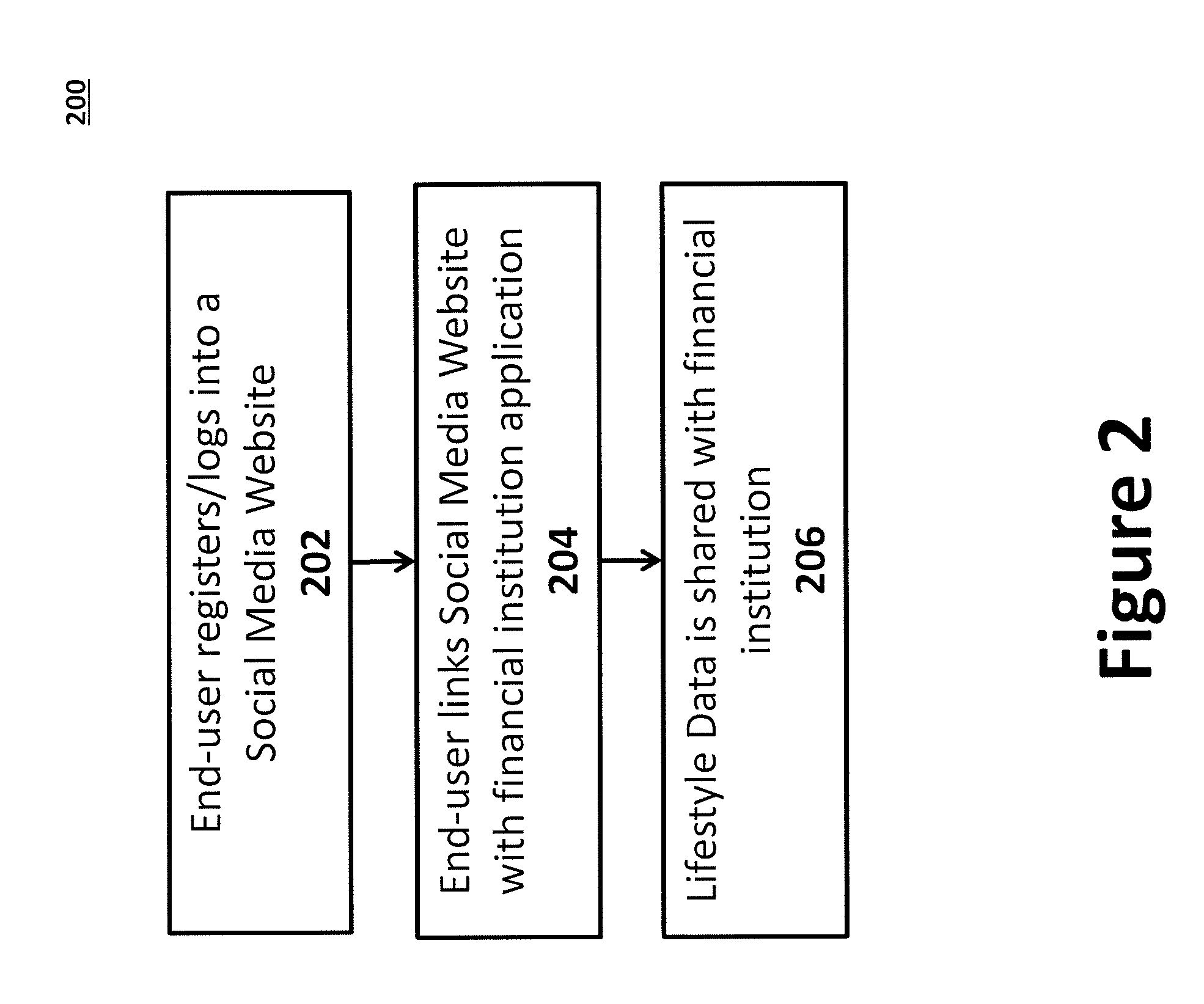

The present invention relates to system and method for authorizing a transaction using user data collected from third-party websites / applications / sources, such as social media networks. In operation, collected user data may be compared to a financial data or user data collected during a transaction to identify potential fraud and / or other discrepancies, confirming the identity of the user with a greater degree of accuracy and / or imposing purchase parameters.

Owner:ALLOWIFY

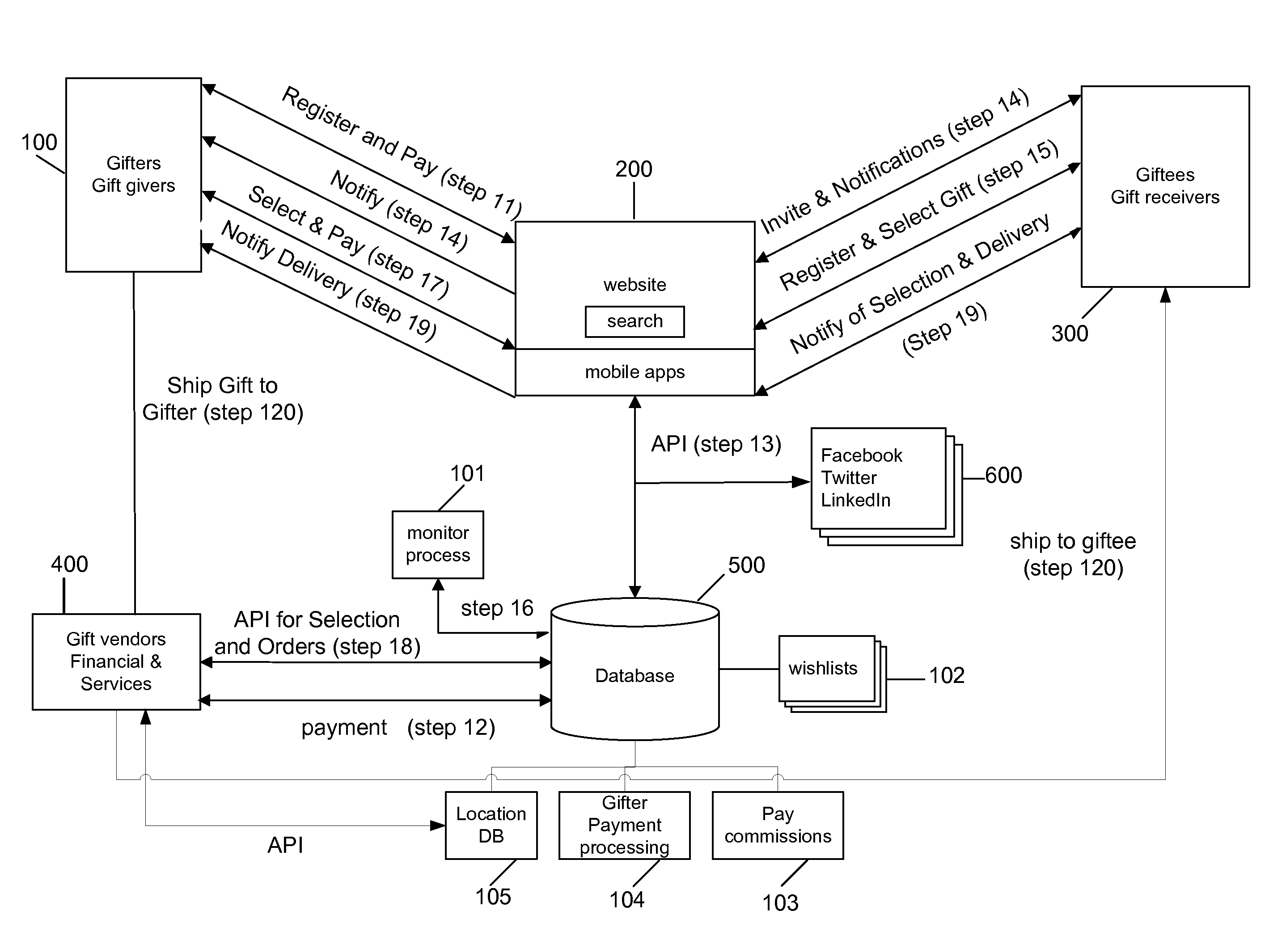

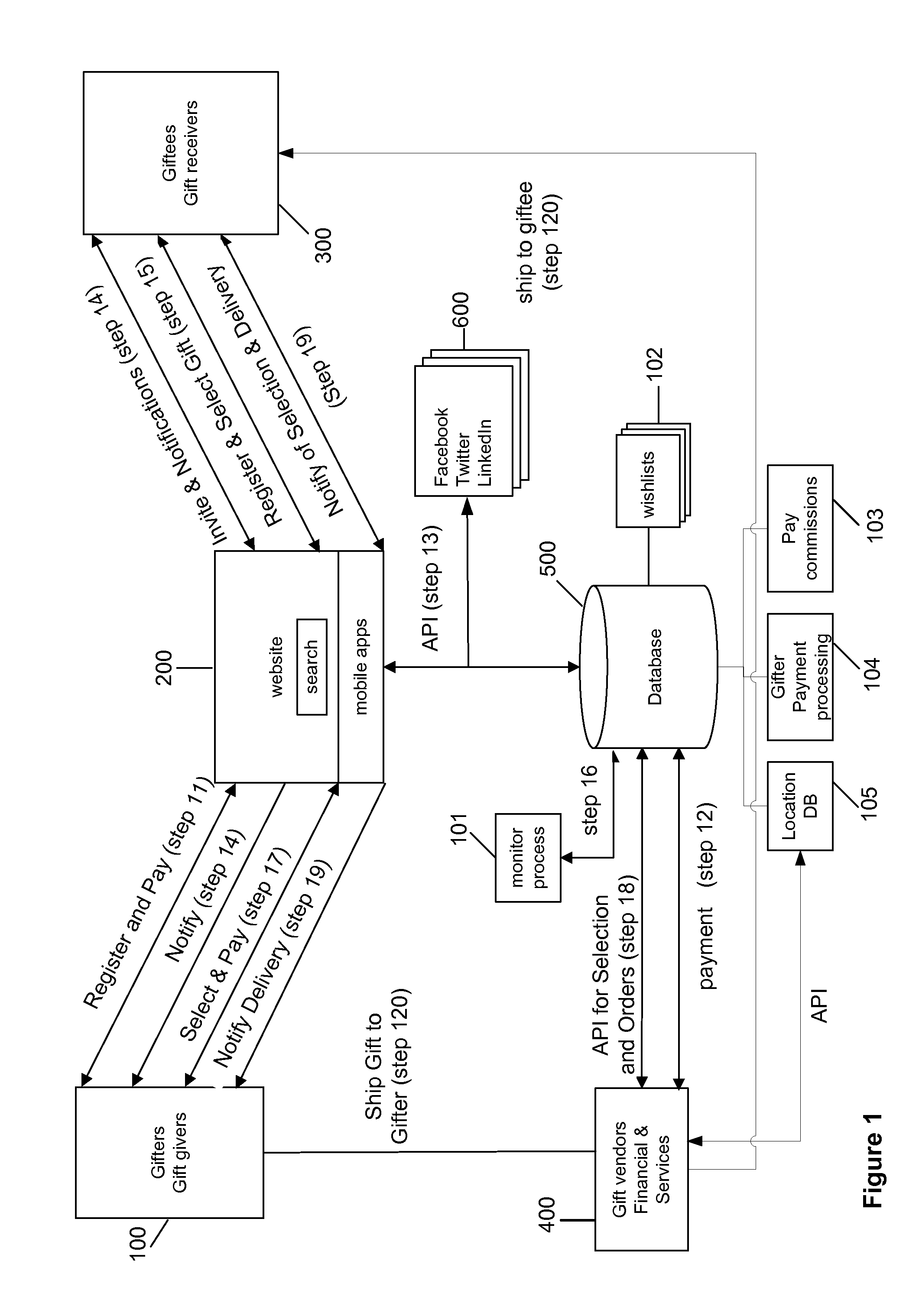

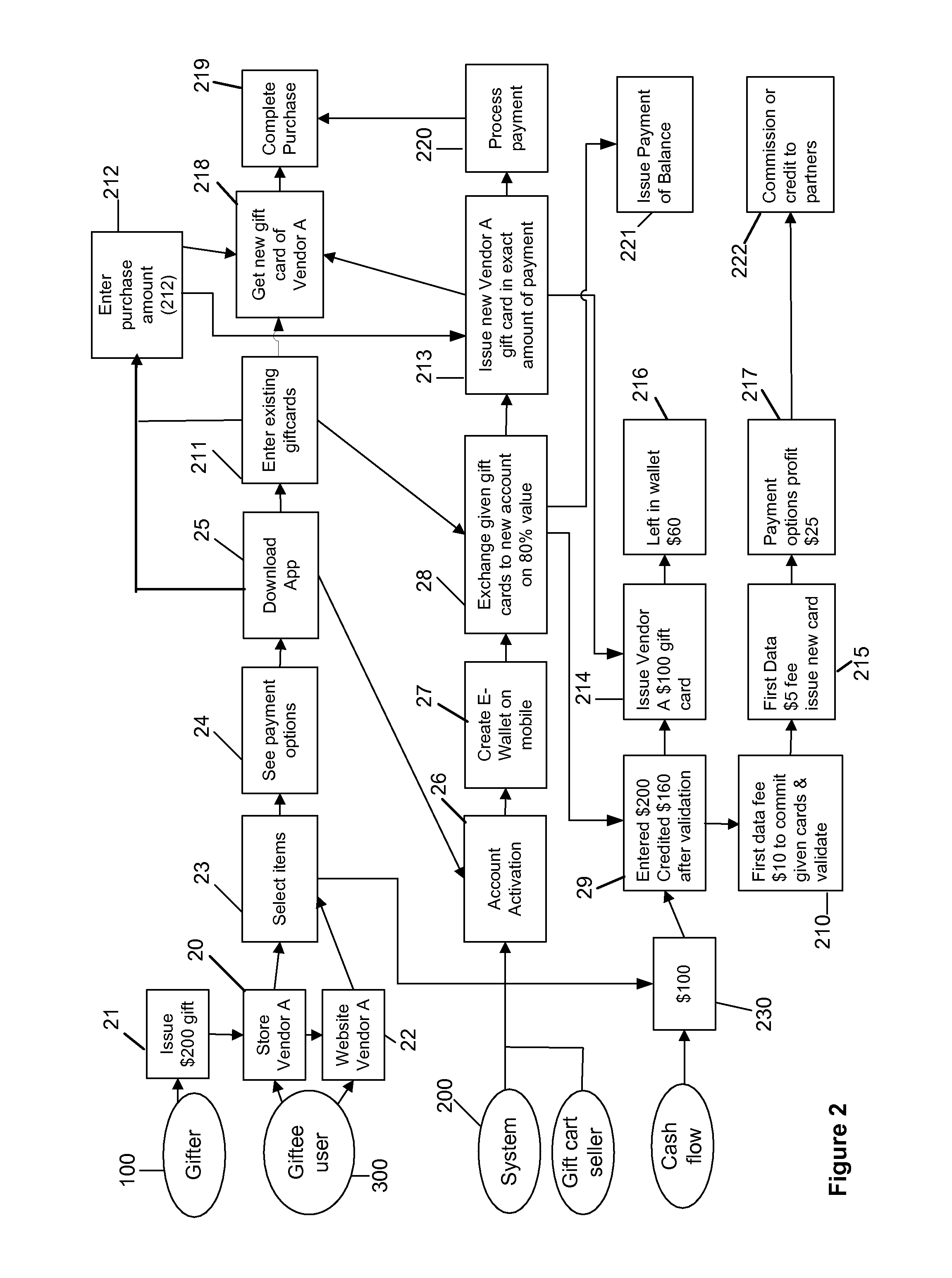

System and method for crowdsourcing, selecting, transacting gifts and financial discounts in physical stores and e-commerce environments

A computer system and software enabling a method for assisting users who are members of a group in identifying trending items and making purchases using selected forms of payment over the Internet on web sites, mobile devices and in physical store locations from trusted vendors to locate and to take advantage of special rates and promotions that may be offered to certain users under specific circumstances. The system enables users, buyers and their social circle of friends of gift givers to identify, curate, manage and purchase gifts & services and take advantage of digital gift cards, credit cards & coupons to get the best price.

Owner:MASHINSKY ALEX

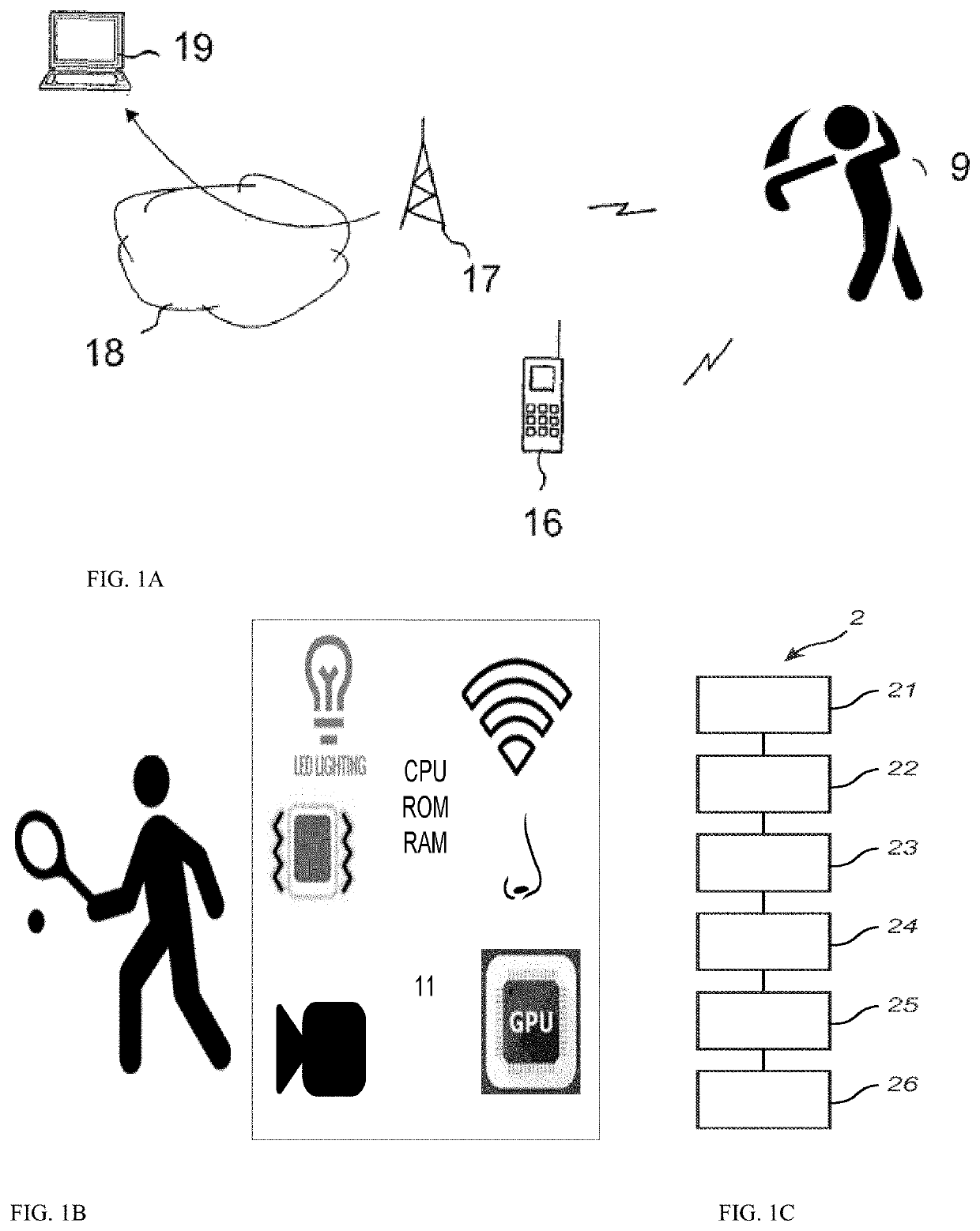

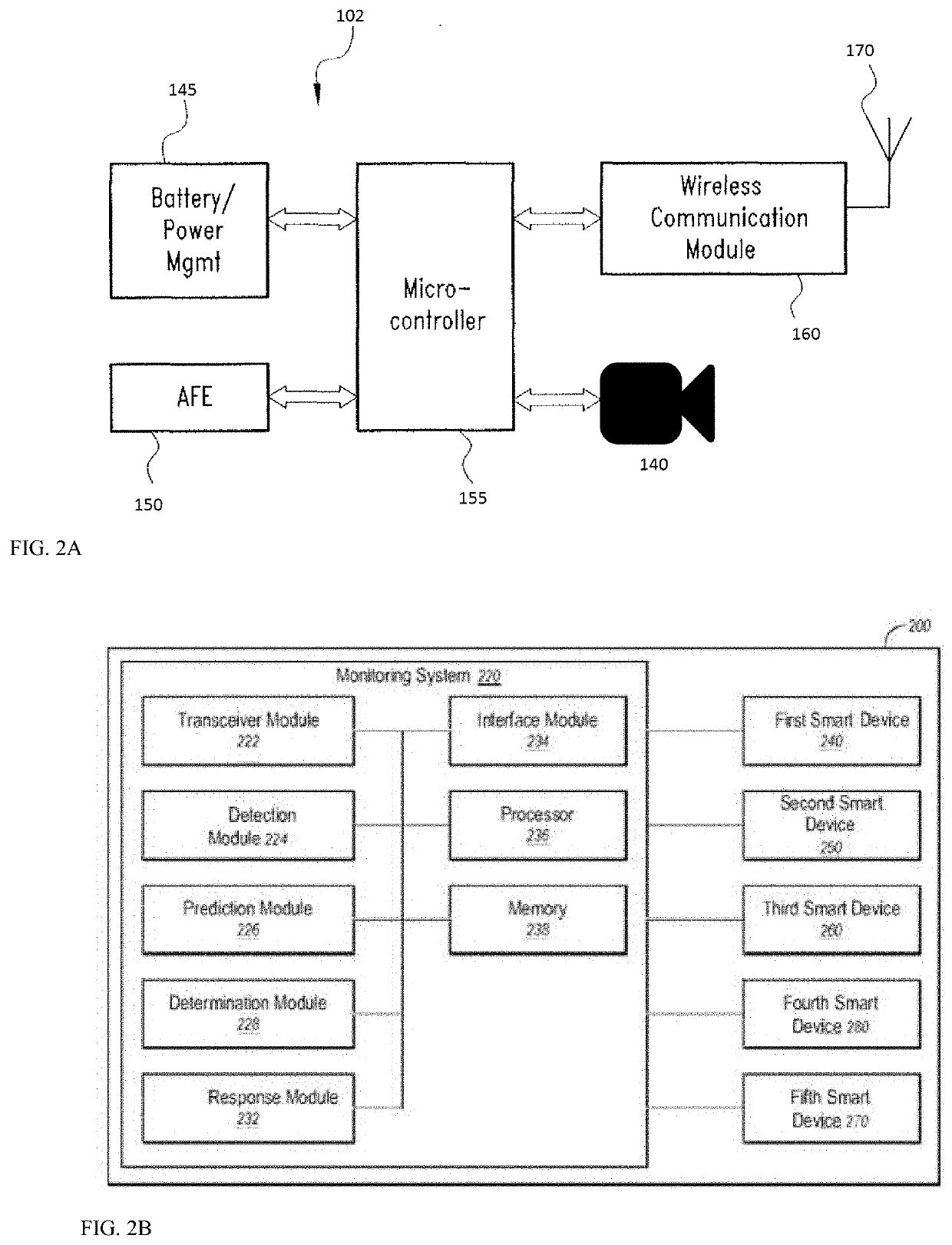

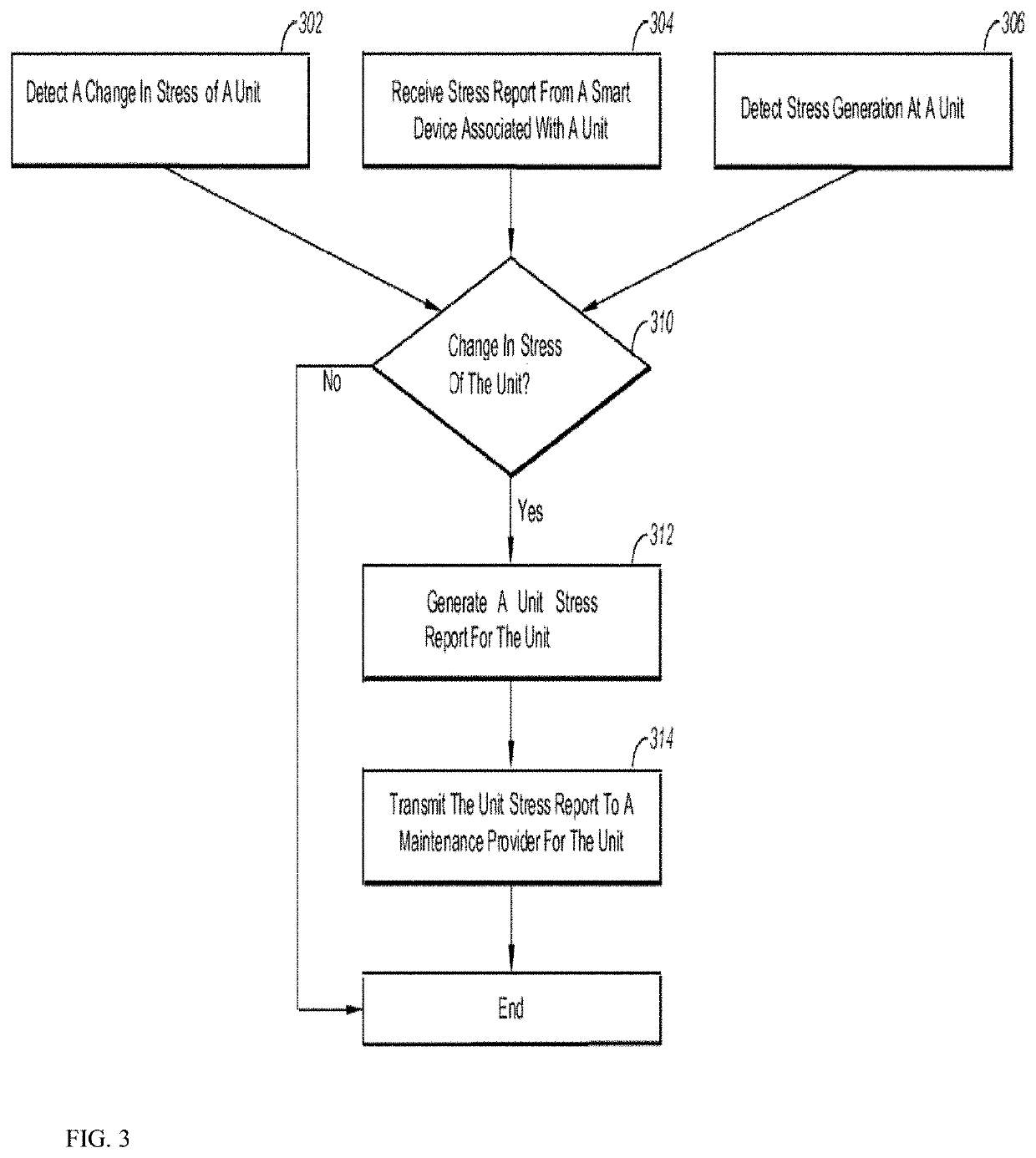

Smart device

InactiveUS20190361917A1Readily apparentFinanceCryptography processingWireless transceiverTransceiver

An Internet of Thing (IoT) device includes a camera coupled to a processor; and a wireless transceiver coupled to the processor. Blockchain smart contracts can be used with the device to facilitate secure operation.

Owner:TRAN BAO

Popular searches

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com