Patents

Literature

826 results about "Debit card" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

A debit card (also known as a bank card, plastic card or check card) is a plastic payment card that can be used instead of cash when making purchases. It is similar to a credit card, but unlike a credit card, the money is immediately transferred directly from the cardholder's bank account when performing any transaction.

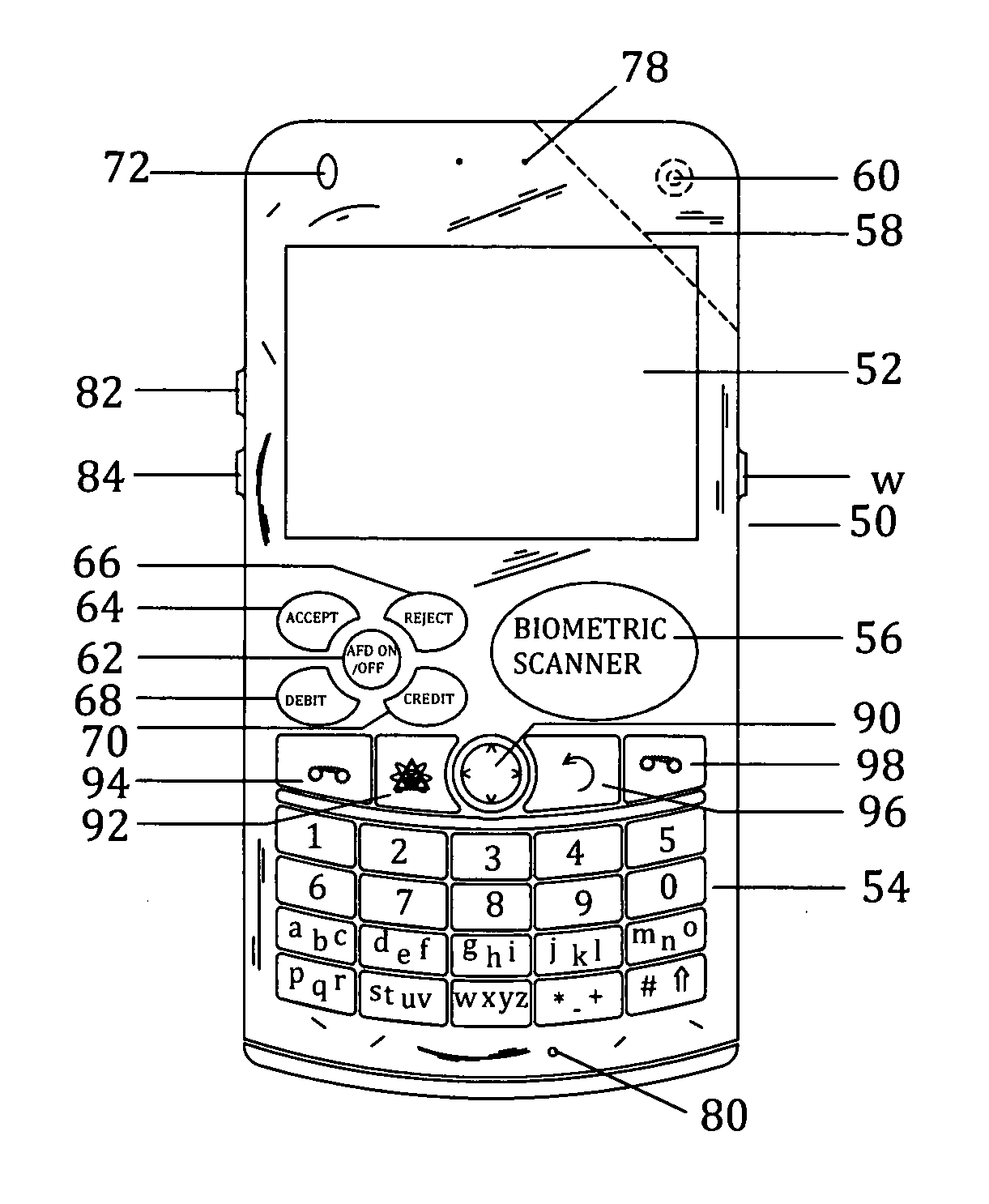

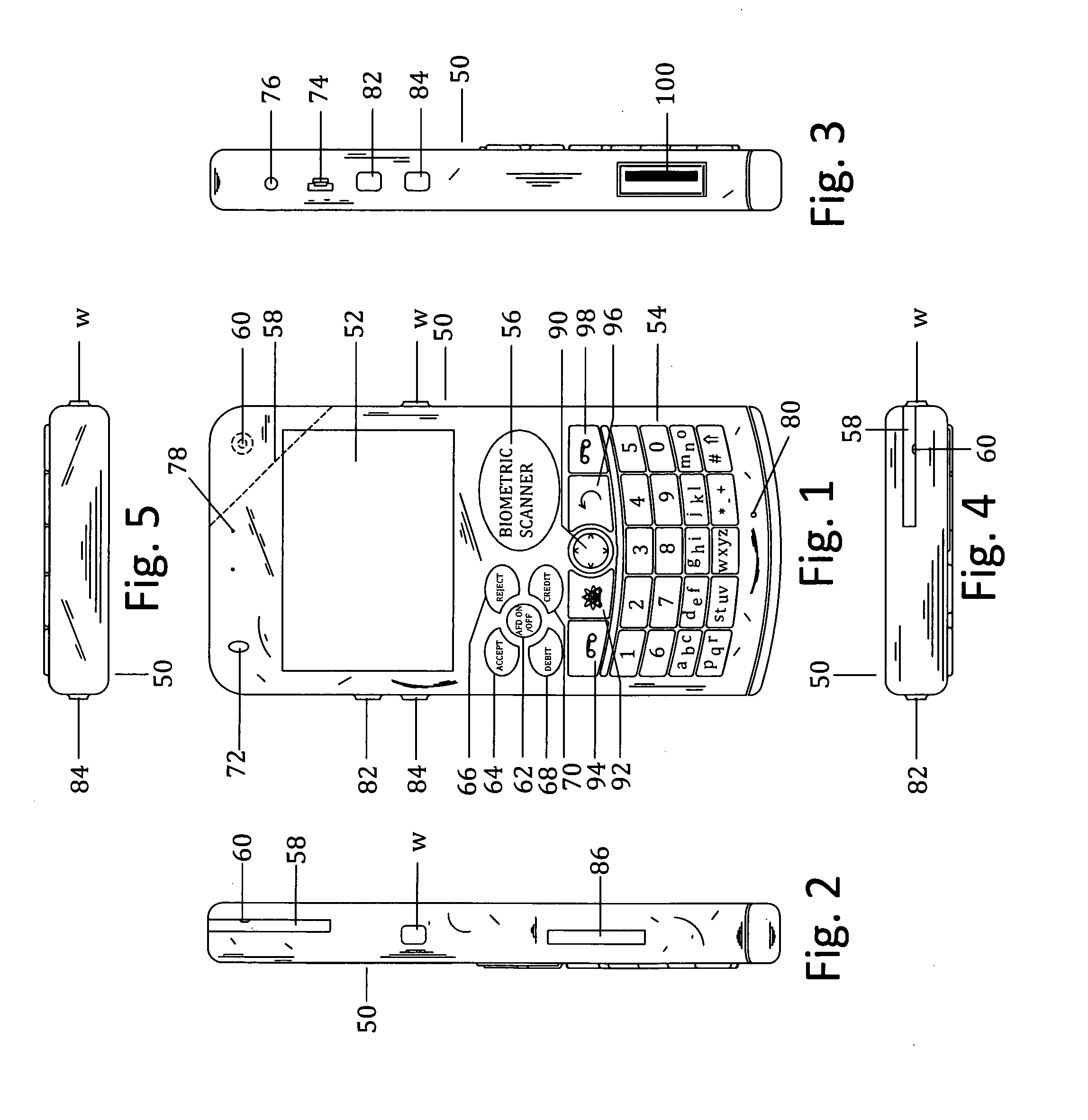

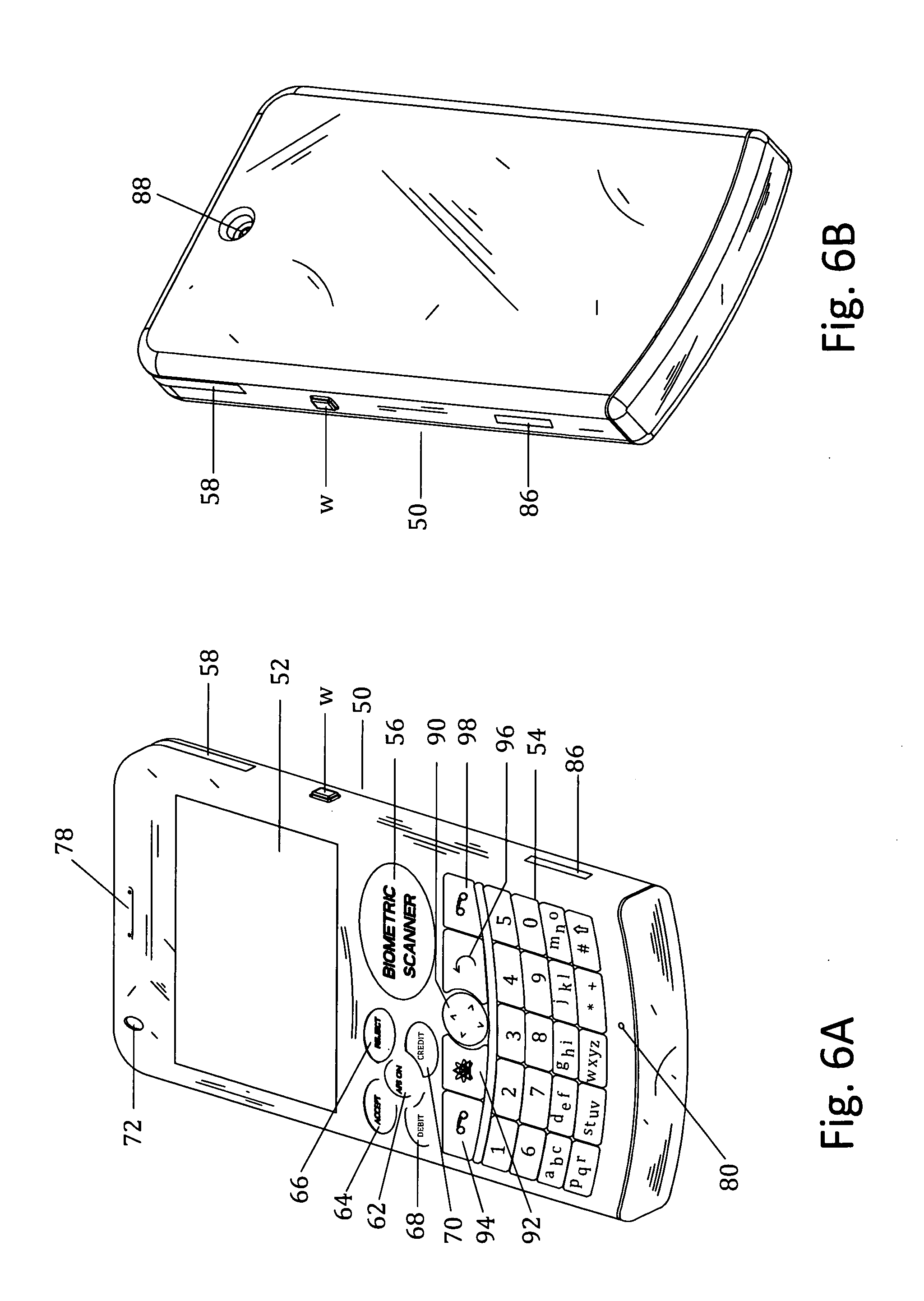

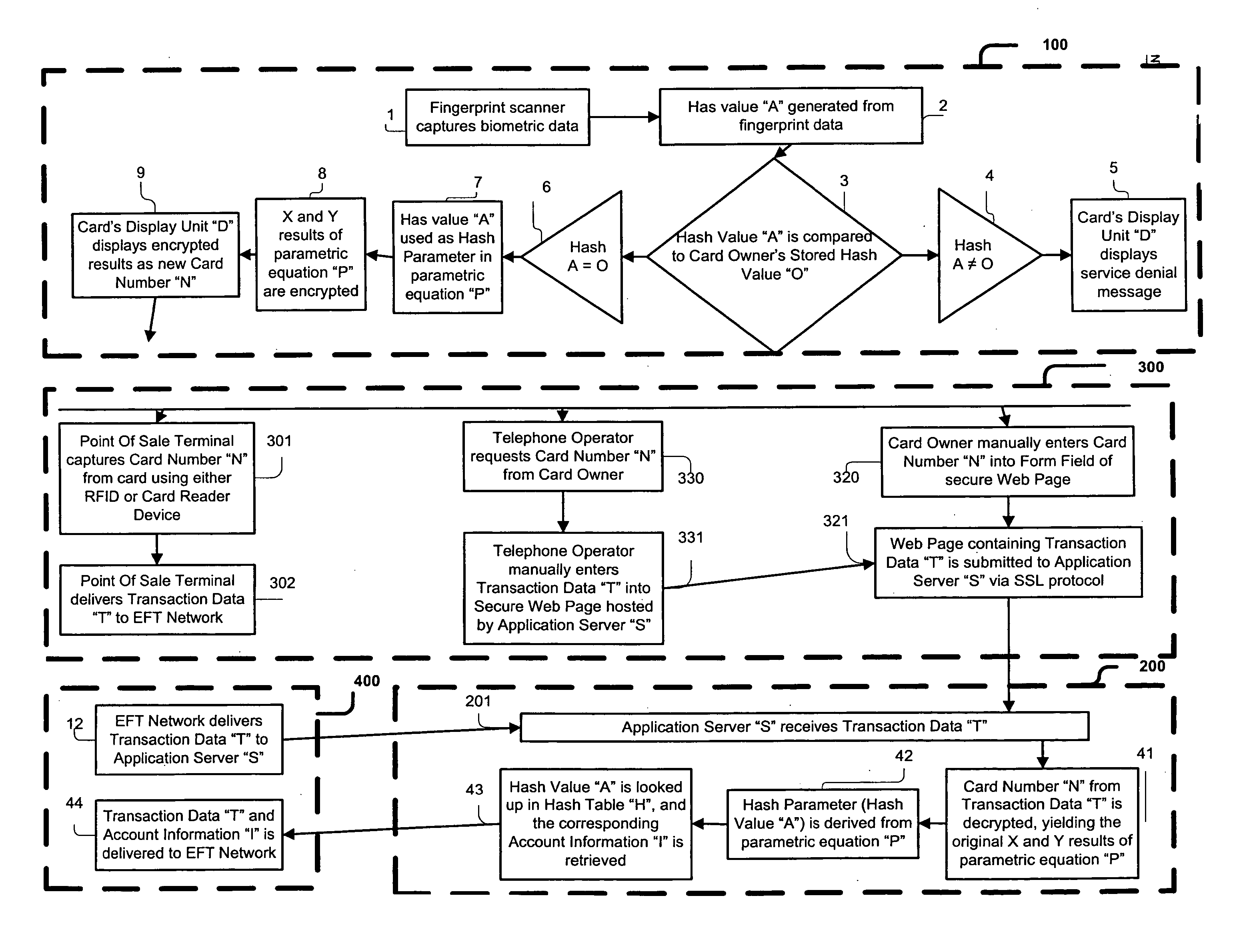

Customer-controlled instant-response anti-fraud/anti-identity theft devices (with true- personal identity verification), method and systems for secured global applications in personal/business e-banking, e-commerce, e-medical/health insurance checker, e-education/research/invention, e-disaster advisor, e-immigration, e-airport/aircraft security, e-military/e-law enforcement, with or without NFC component and system, with cellular/satellite phone/internet/multi-media functions

ActiveUS20140162598A1Prevent fraudulent multiple swipingDevices with card reading facilityUnauthorised/fraudulent call preventionChequeMessage passing

All-in-one wireless mobile telecommunication devices, methods and systems providing greater customer-control, instant-response anti-fraud / anti-identity theft protections with instant alarm, messaging and secured true-personal identity verifications for numerous registered customers / users, with biometrics and PIN security, operating with manual, touch-screen and / or voice-controlled commands, achieving secured rapid personal / business e-banking, e-commerce, accurate transactional monetary control and management, having interactive audio-visual alarm / reminder preventing fraudulent usage of legitimate physical and / or virtual credit / debit cards, with cheques anti-forgery means, curtailing medical / health / insurance frauds / identity thefts, having integrated cellular and / or satellite telephonic / internet and multi-media means, equipped with language translations, GPS navigation with transactions tagging, currency converters, with or without NFC components, minimizing potential airport risks / mishaps, providing instant aid against school bullying, kidnapping, car-napping and other crimes, applicable for secured military / immigration / law enforcements, providing guided warning / rescue during emergencies and disasters.

Owner:VILLA REAL ANTONY EUCLID C

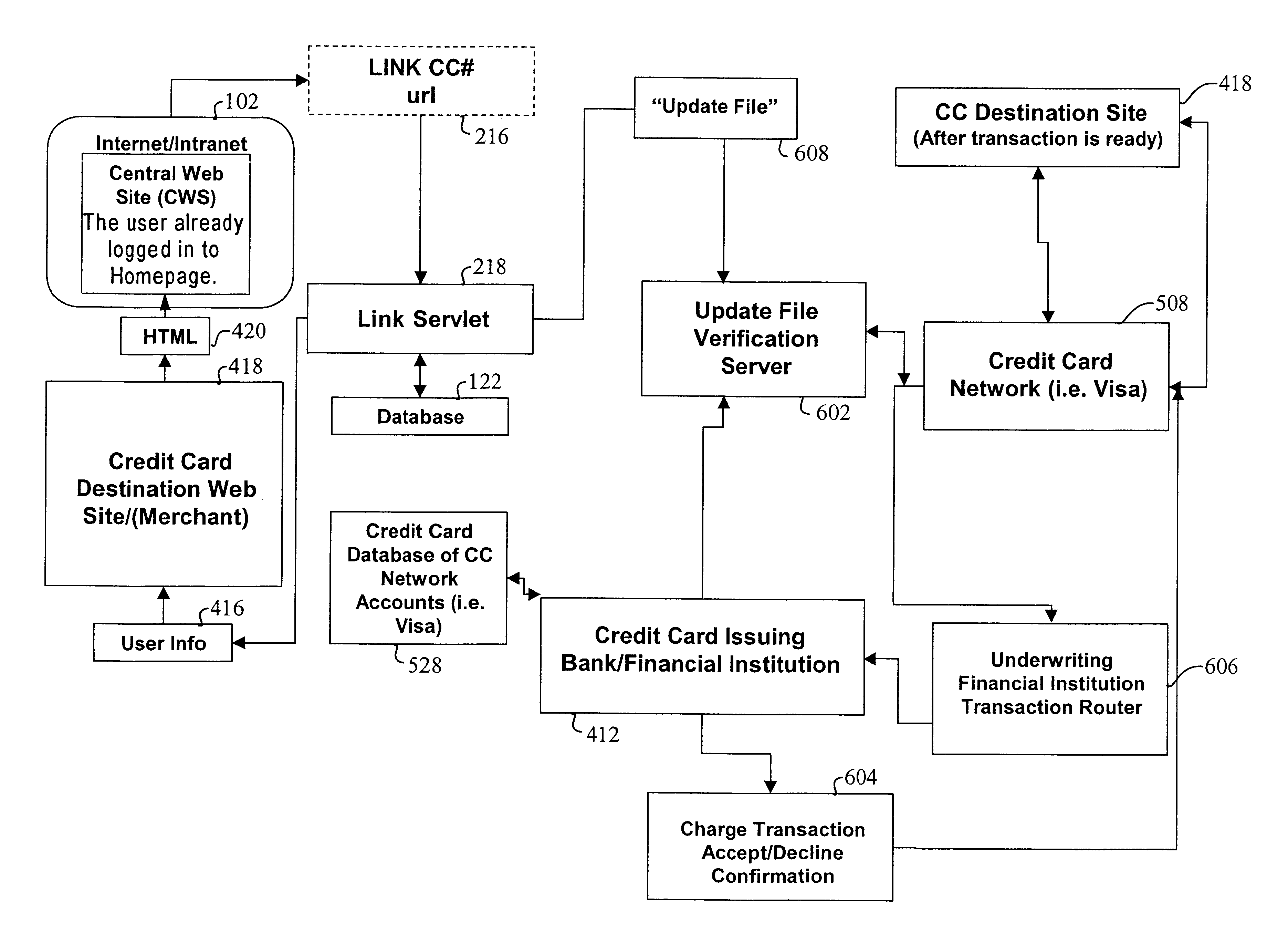

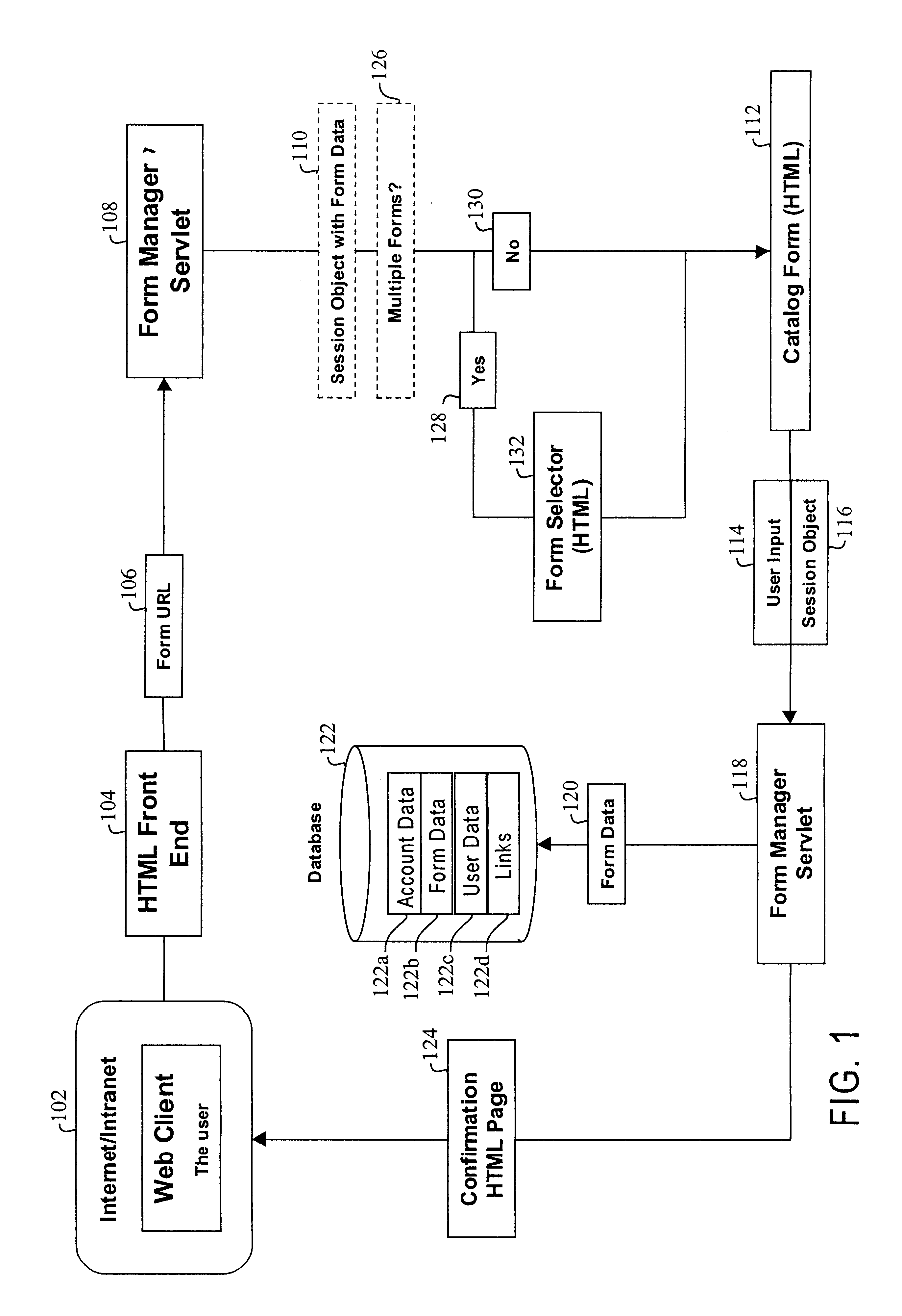

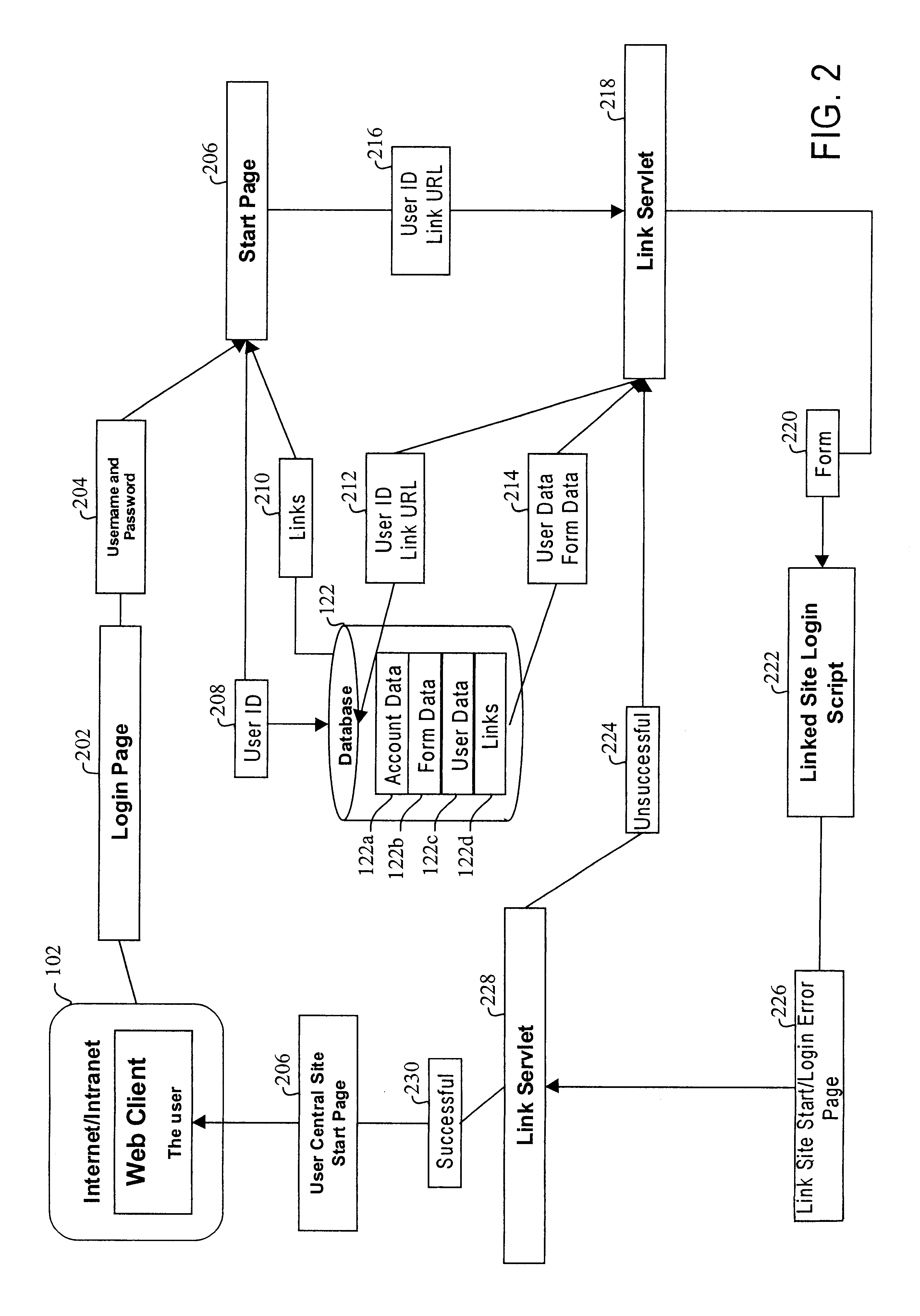

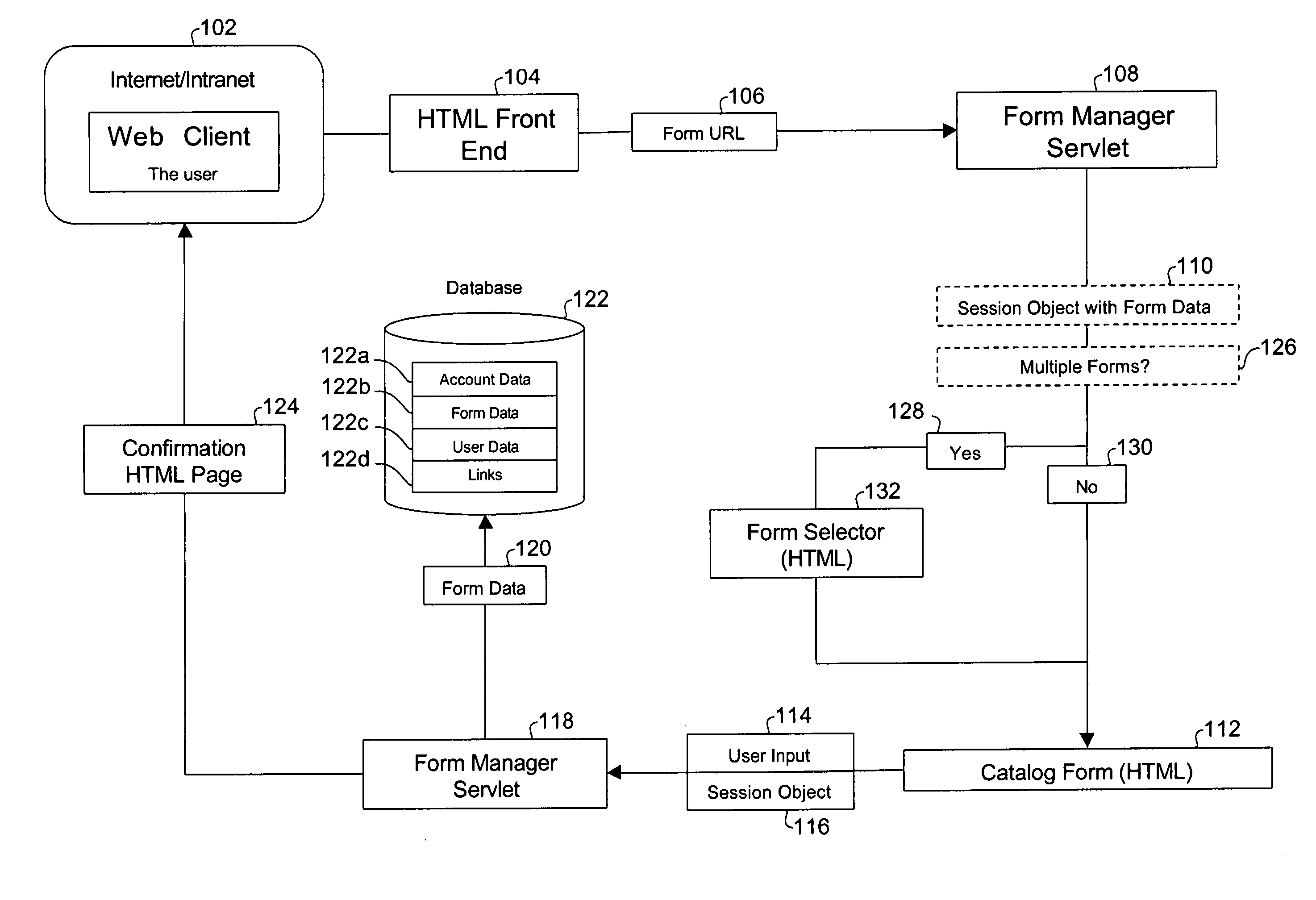

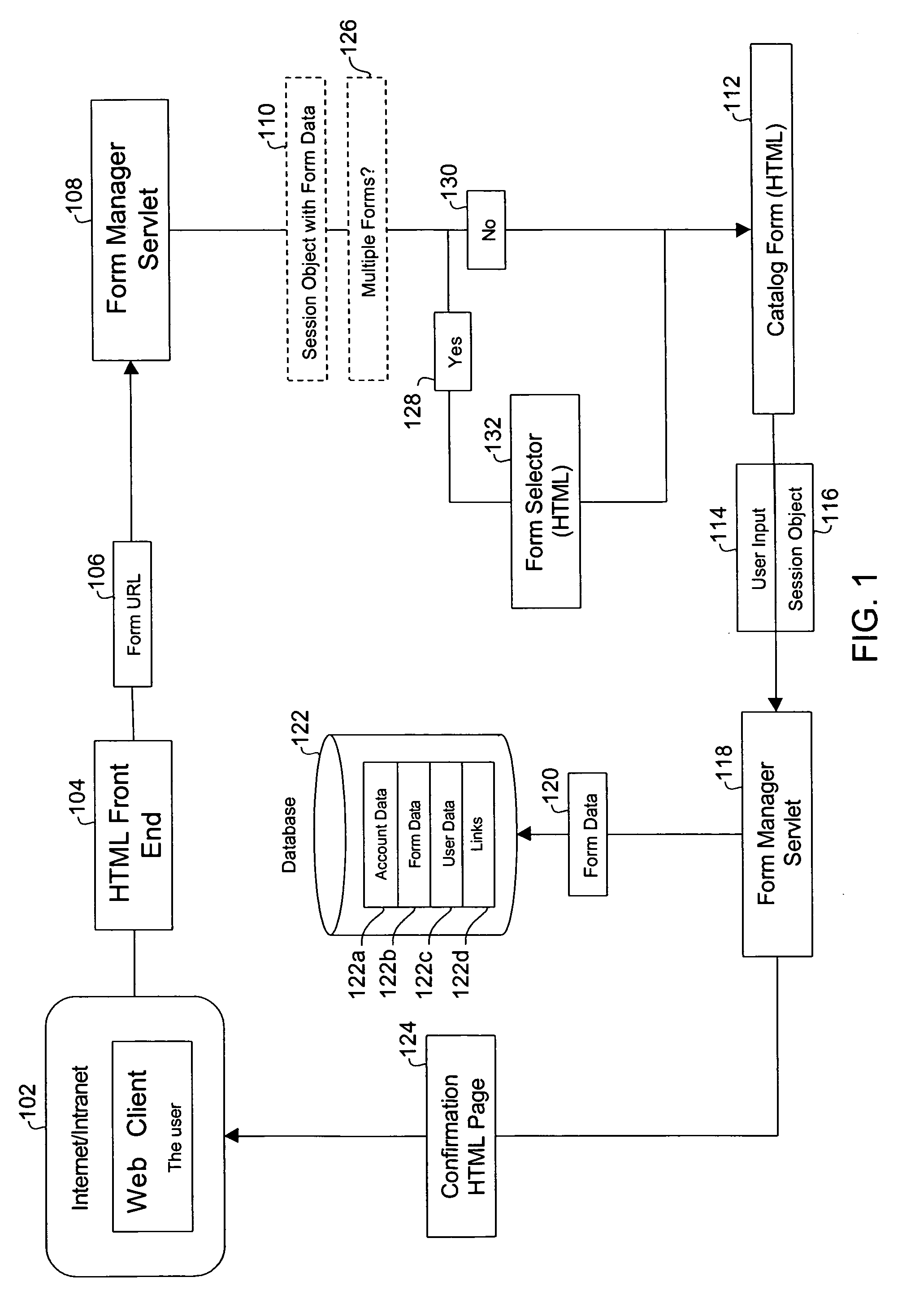

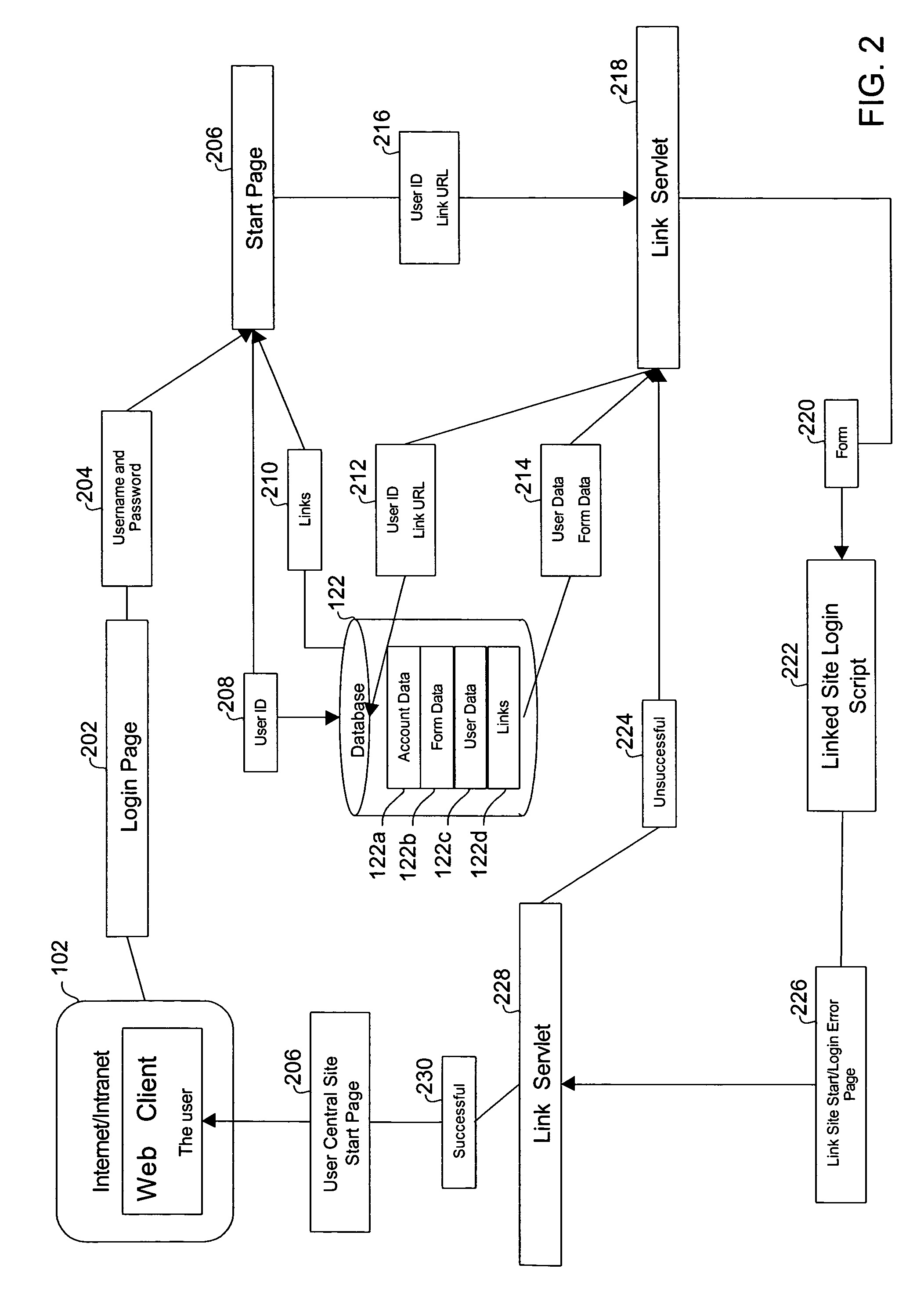

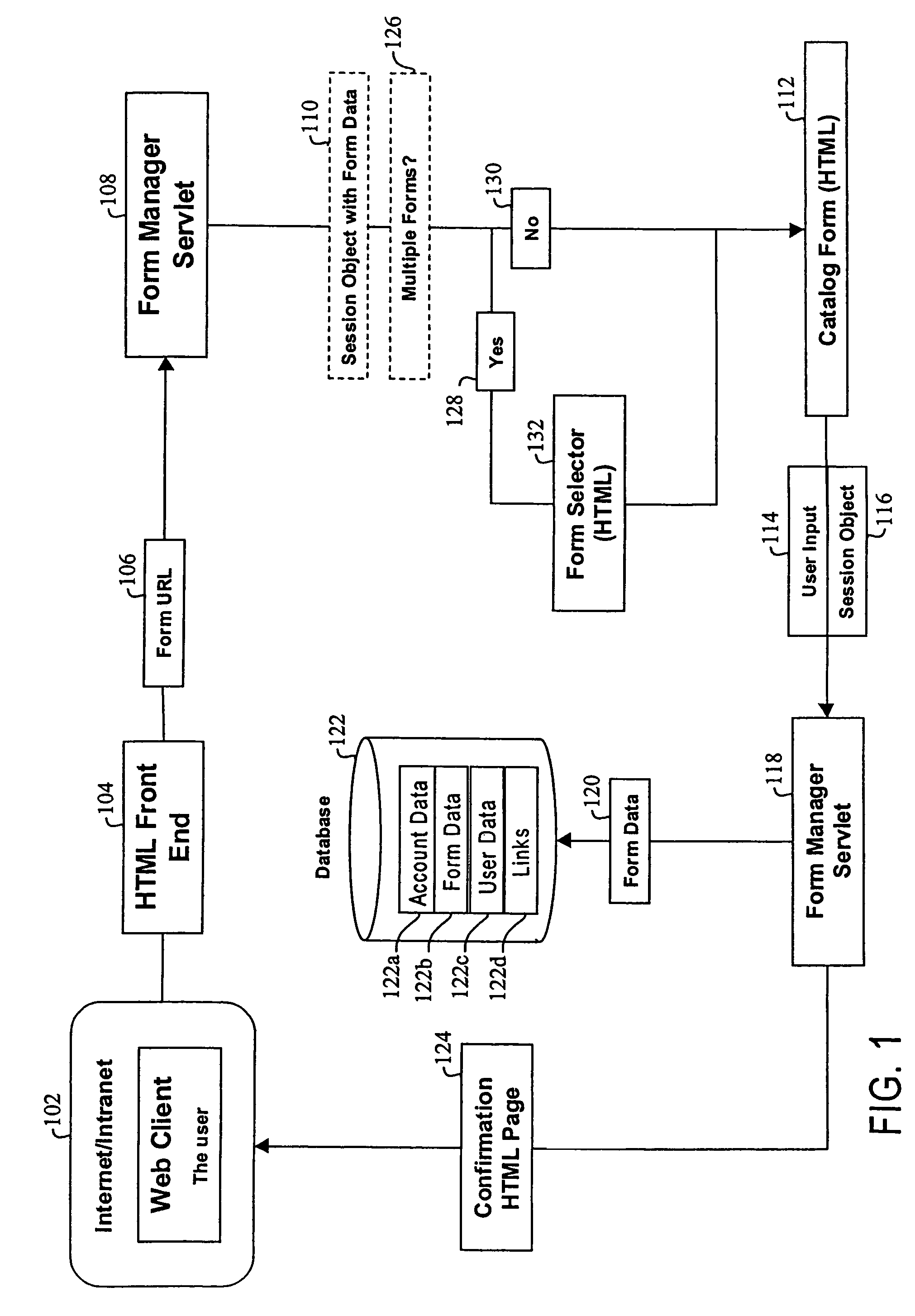

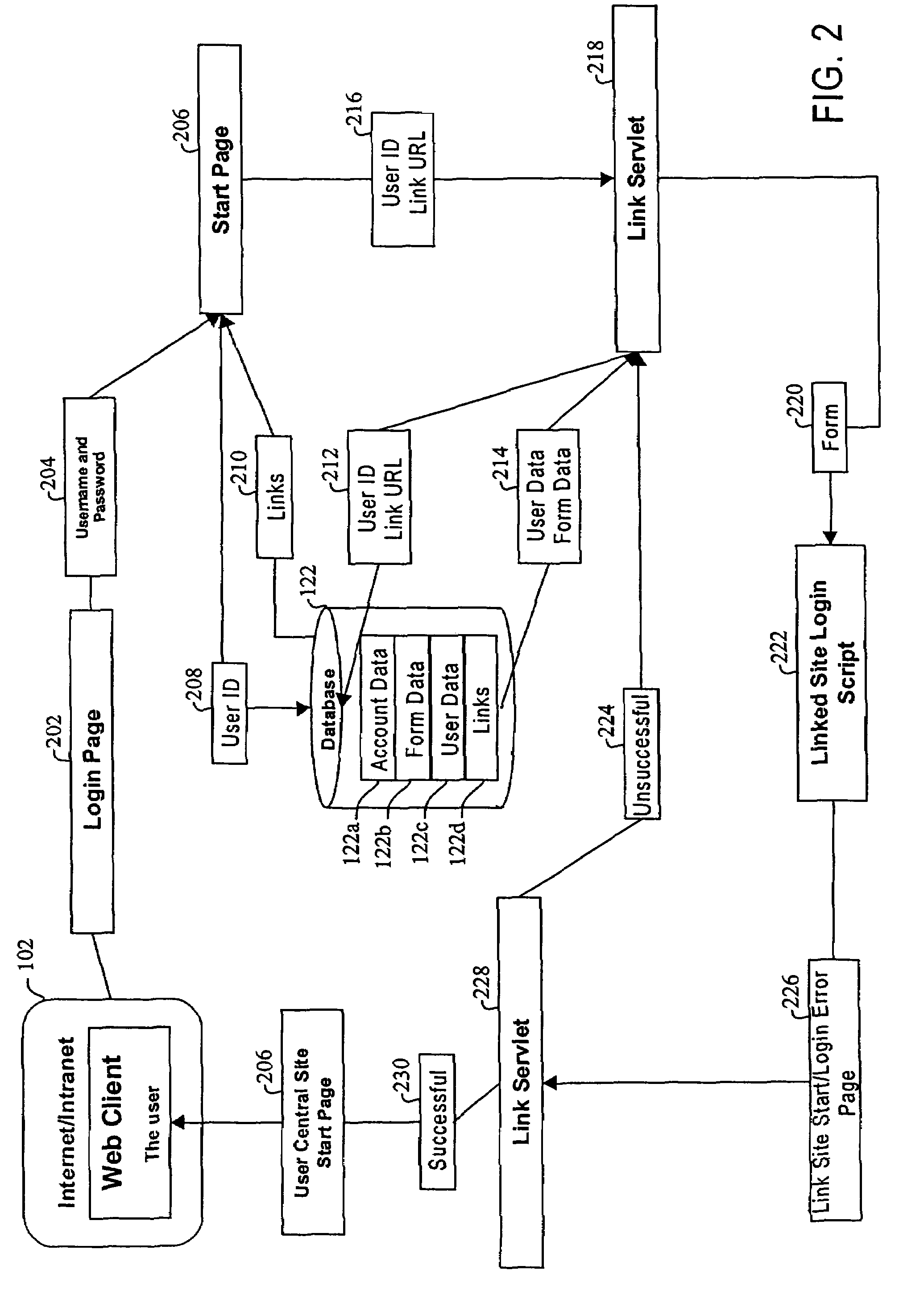

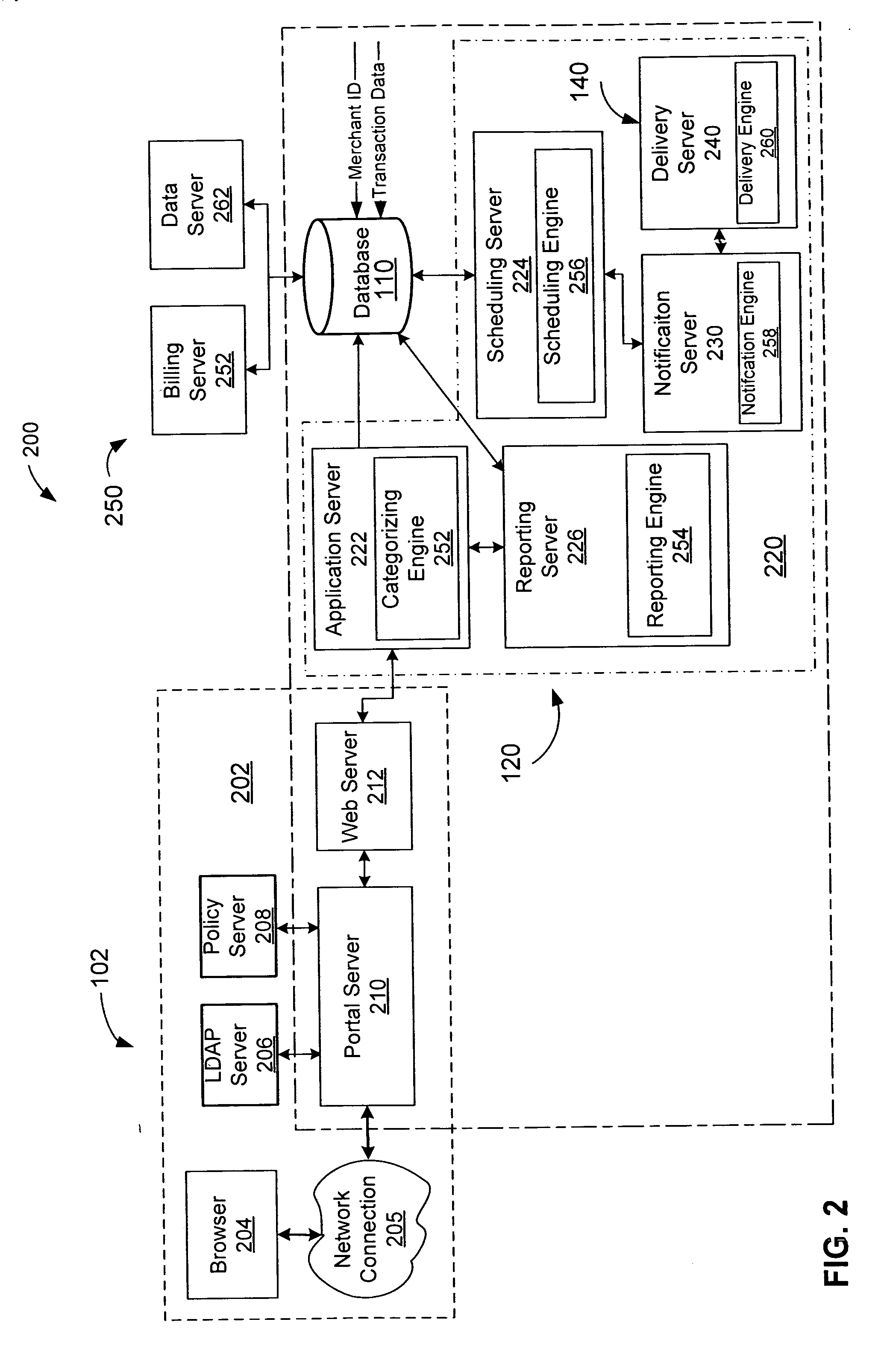

Method, system and computer readable medium for web site account and e-commerce management from a central location

InactiveUS6879965B2Minimizing activation timeMinimizing financial exposureComplete banking machinesAcutation objectsWeb siteData field

A method, system and computer readable medium for, from a central Web site, performing at least one of registering a user at a destination Web site, logging in a user at a destination Web site and managing an online financial transaction at a destination Web site, including parsing a form Web page of the destination Web site to extract form data fields therefrom; mapping form data fields of a central Web site form to corresponding extracted form data fields of the form Web page of the destination Web site; and using the mapped form data fields to perform at least one of registering a user at the destination Web site, logging in a user at the destination Web site and managing an online financial transaction of a user at the destination Web site. In another aspect, there is provided a method, system and computer readable medium for managing an online or offline financial transaction of a user, from a central Web site, including generating financial transaction account information for a user based on existing credit or debit card information; gathering from the user one or more limits that are applied to a financial transaction performed based on the financial transaction account information; receiving from a source information indicating that an online or offline financial transaction using the financial transaction account information is in progress; applying the one or more limits gathered from the user to approve or disapprove the online or offline or online financial transaction that is in progress; and transmitting an approval or disapproval signal to the source based on a result of the applying step.

Owner:SLINGSHOT TECH LLC

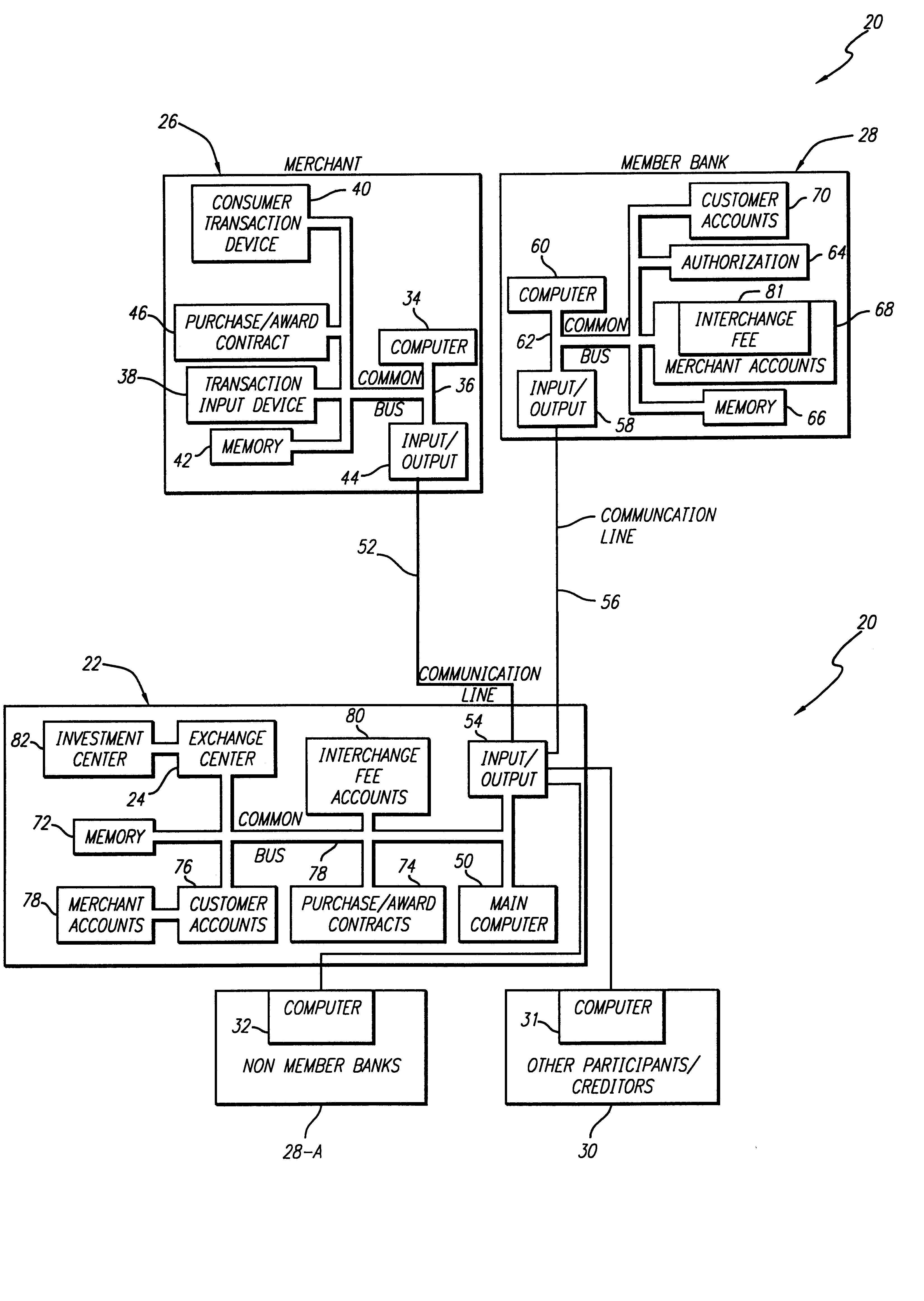

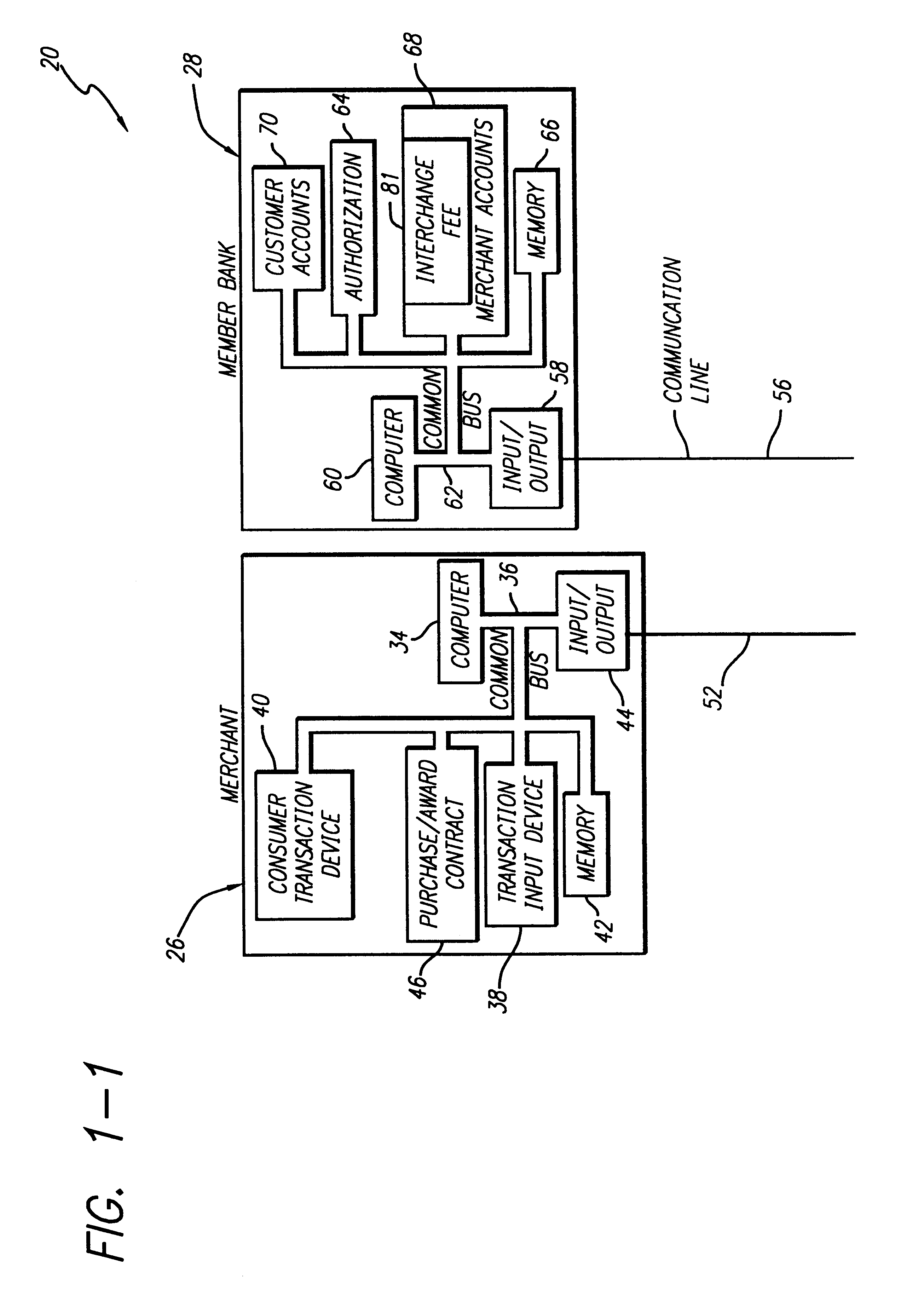

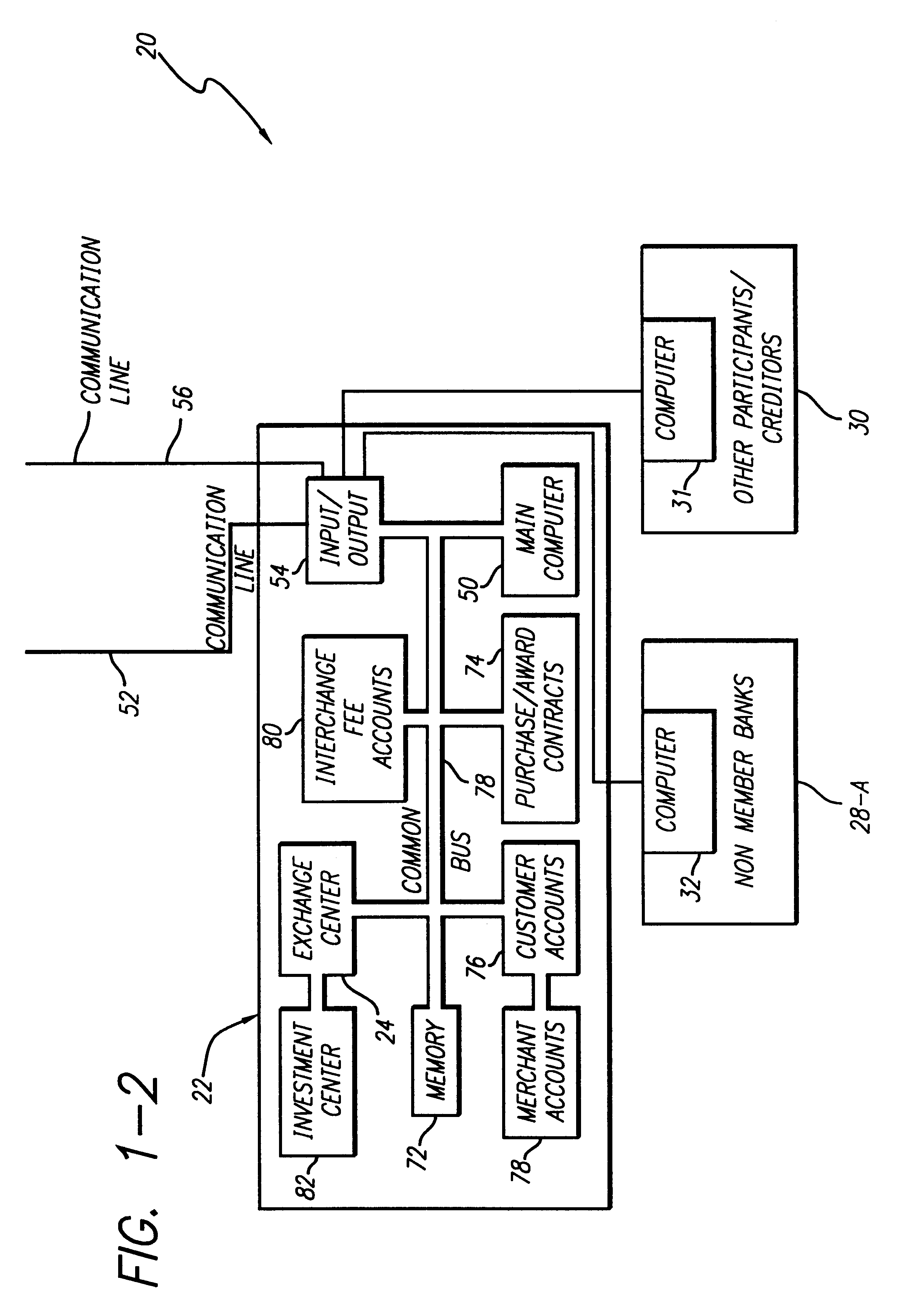

Internet-based credit interchange system of converting purchase credit awards through credit exchange system for purchase of investment vehicle

An Internet-based purchase credit award interchange center is described which interfaces with a credit award exchange center for conversion of any form of merchant or purchase credit award resulting from customer purchase of goods or services to investment in a mutual fund and / or investment vehicle utilizing computer data processing methods. Preassigned purchase credit accumulations earned by a consumer are exchanged from a merchant or creditor through or combination of credit cards, co-branded credit cards, PIN cards, debit and smart cards, coupons, stamps, proof of purchase, rebates, or any form of purchase award of merchant or creditors choice for an investment in a mutual fund or other investment vehicle. A specific implementation is described wherein a credit card account having investment credit awards is issued through the Internet to a customer. While inputting information through the Internet necessary for establishing the credit card account, the customer also provides any information needed to authorize the purchase of investment vehicles on his or her behalf. Any forms that need to be signed by the customer to authorize purchase of the investment vehicles may be printed out by the customer. The customer may also select, via the Internet, particular investment vehicles out of a group of possible investment vehicles. Subsequent use of the credit card by the customer automatically results in accrual of credit award accumulations in the selected investment vehicle.

Owner:KALINA DYAN T

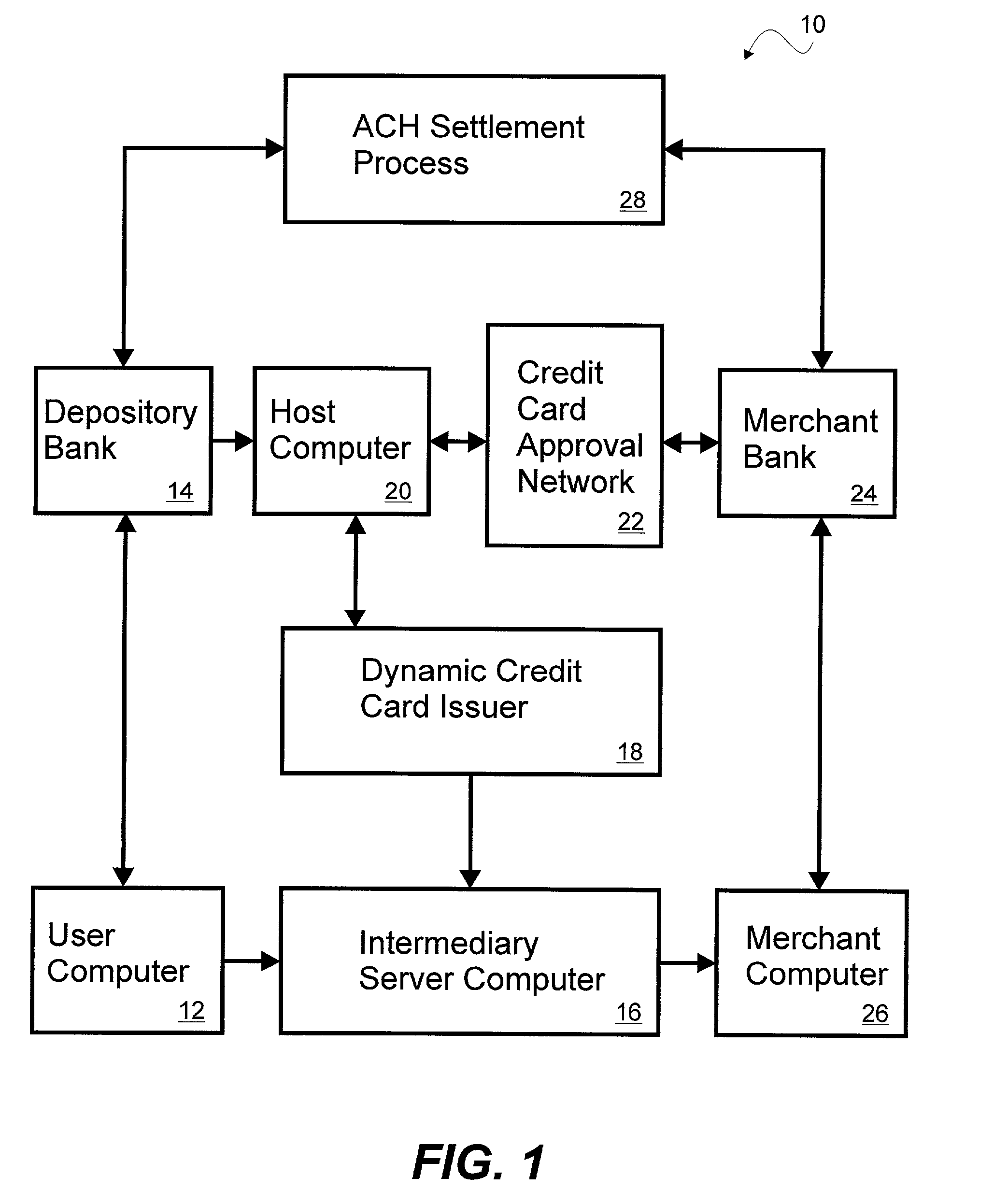

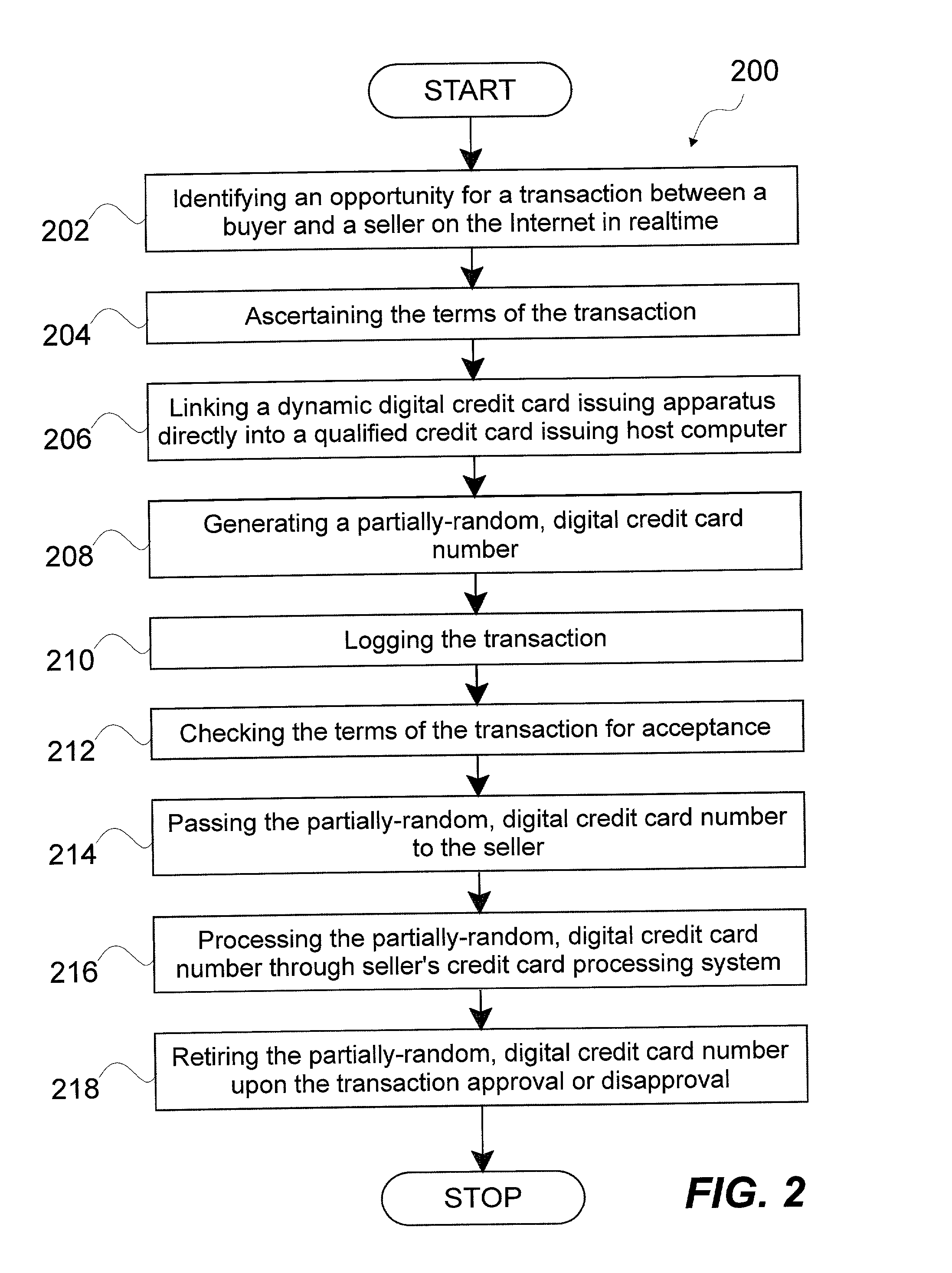

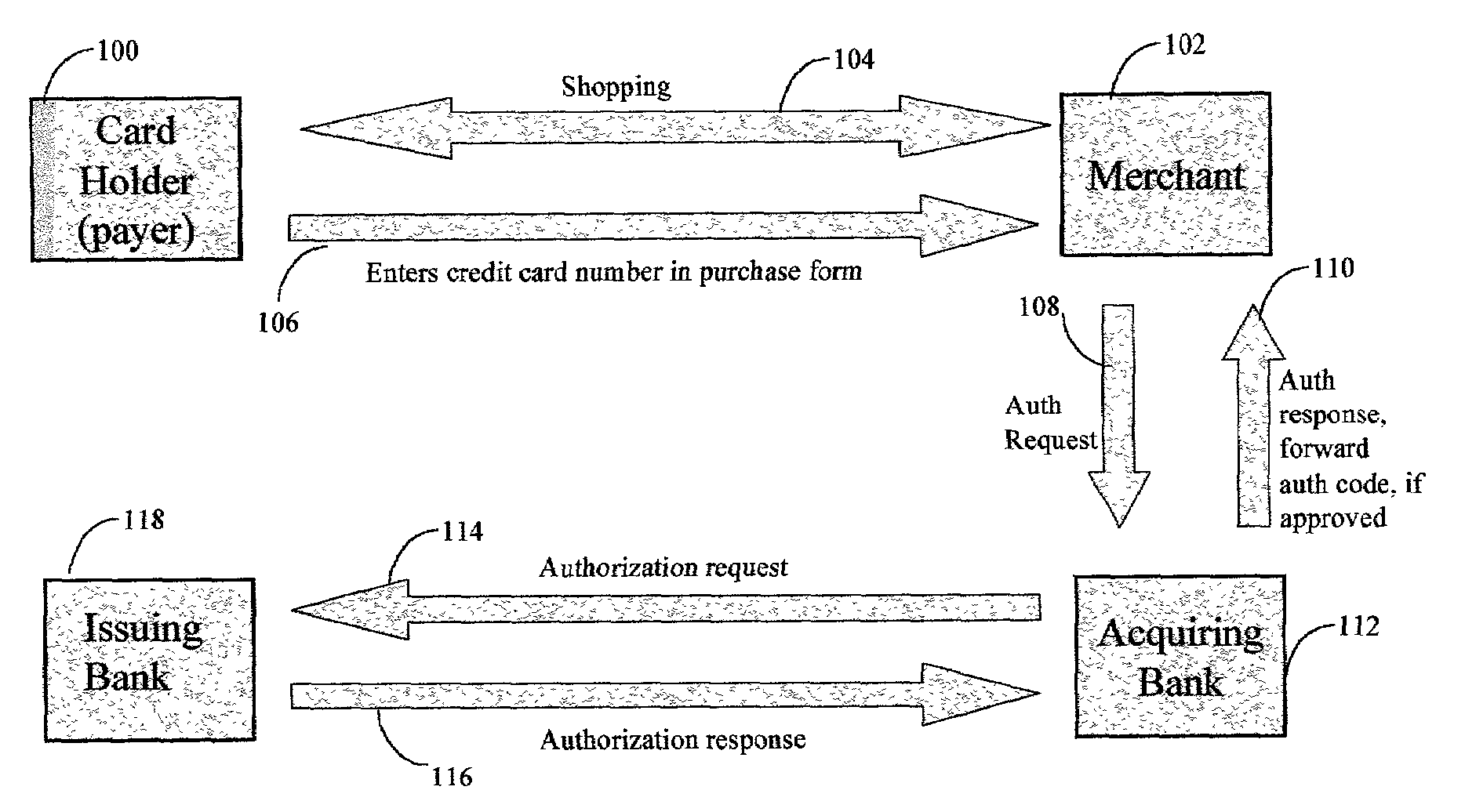

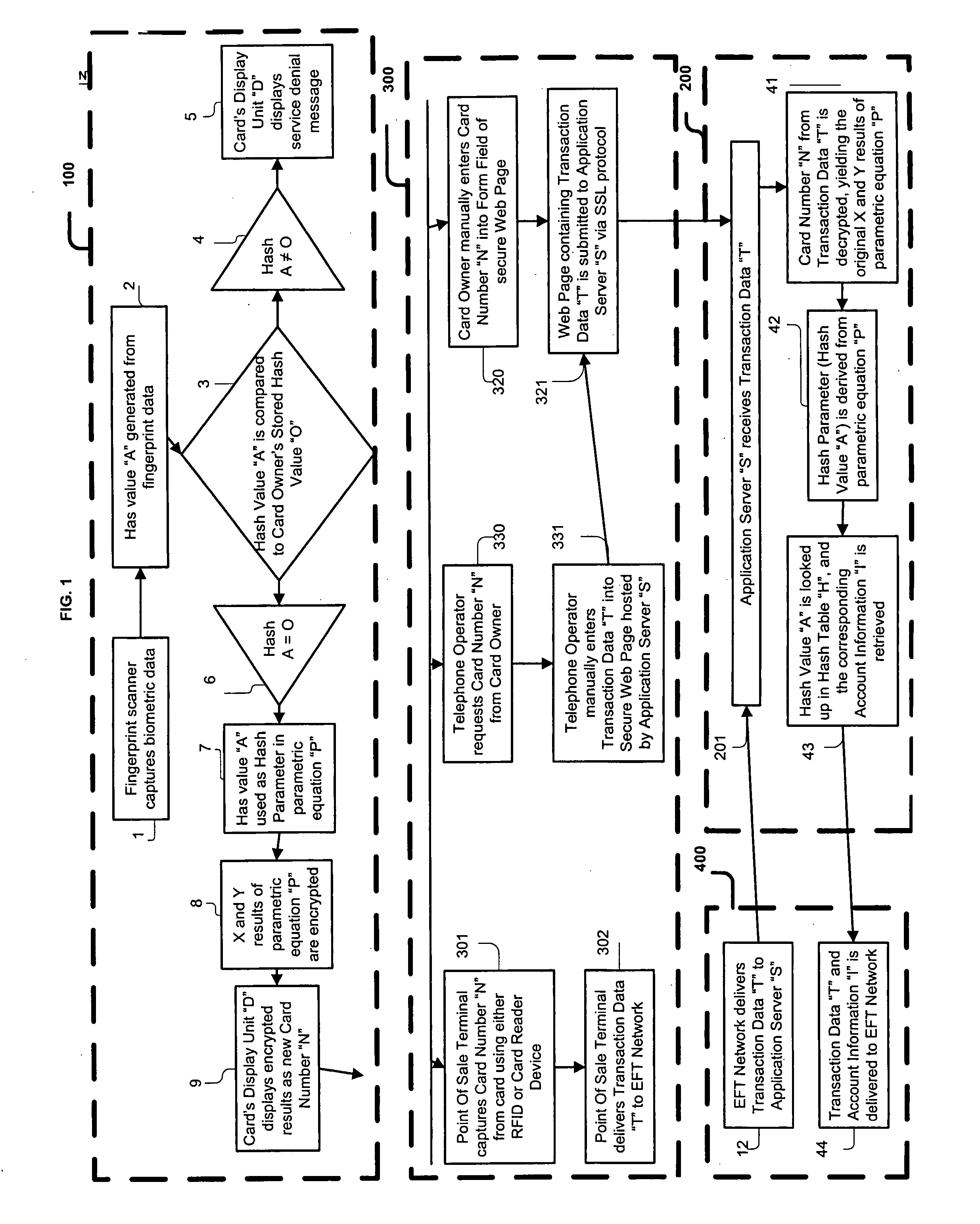

System and method for dynamically issuing and processing transaction specific digital credit or debit cards

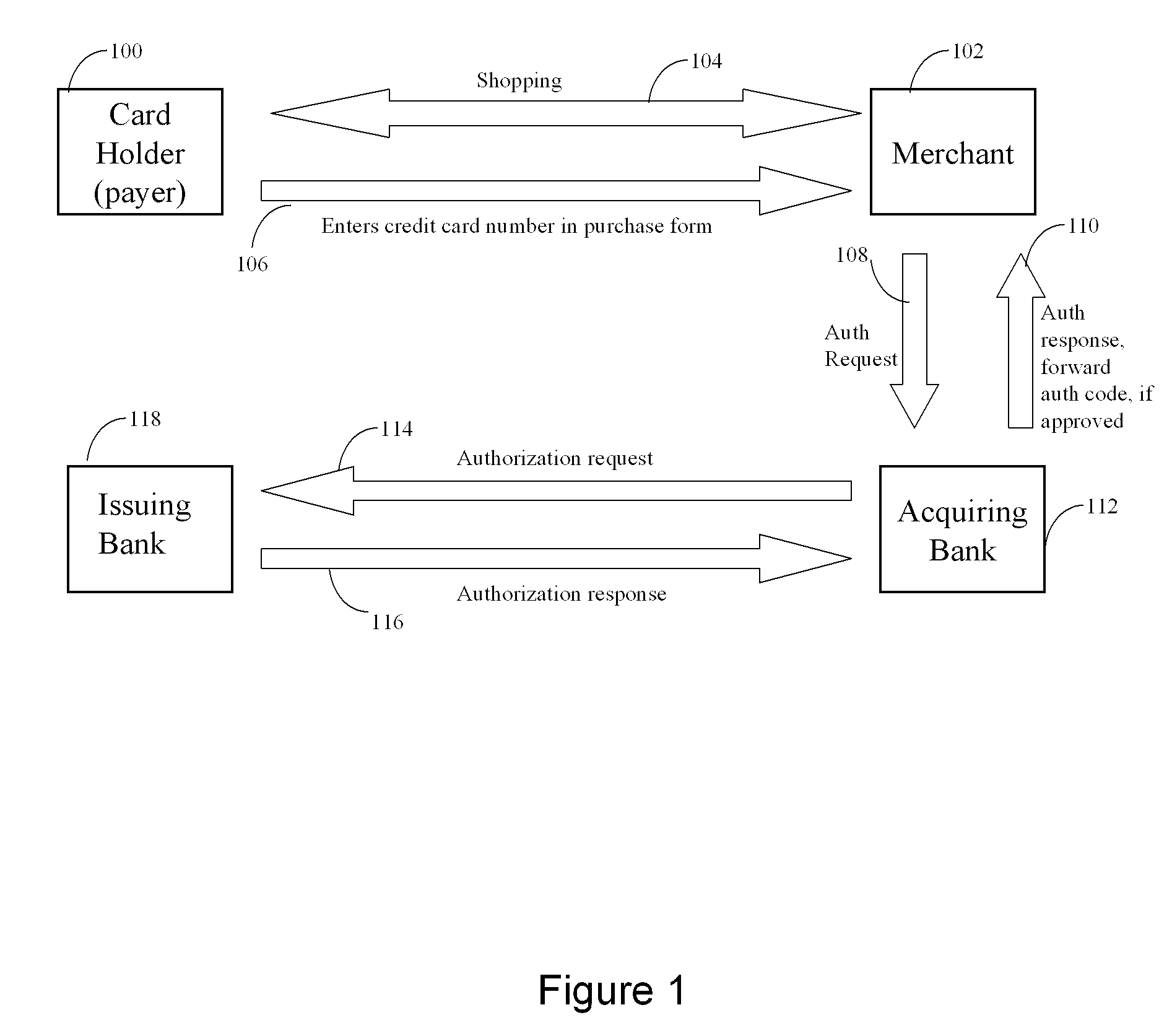

A system and method of dynamically issuing credit card numbers and processing transactions using those credit card numbers is disclosed. A method according to the invention includes digitally recognizing a transaction opportunity on the Internet in real-time, recognizing the terms of the transaction, linking a dynamic digital credit card issuing apparatus directly into a qualified credit card issuing host, generating a partially random digital credit card number, logging the transaction, checking the terms of the transaction for acceptance, passing the dynamically issued digital credit card number to the merchant, processing the digital credit card number through the merchant's card processing system, receiving the transaction approval request, participating in credit card validity checking systems, processing the approval request in real-time, sending the requesting party a legitimate authorization code, and retiring the digital credit card number immediately upon transaction approval or disapproval. A system according to the invention implements the method of the invention.

Owner:ORANGATANGO

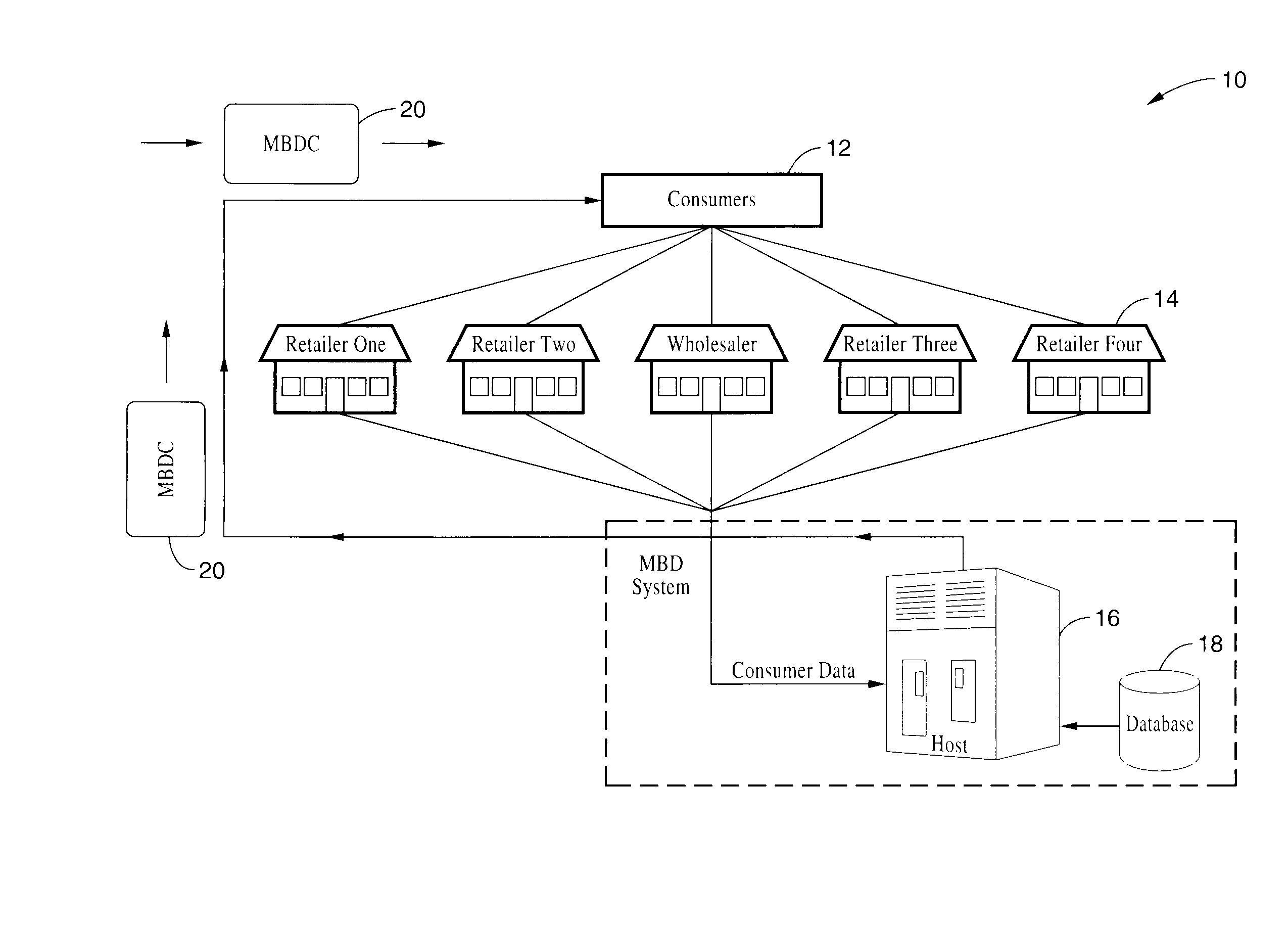

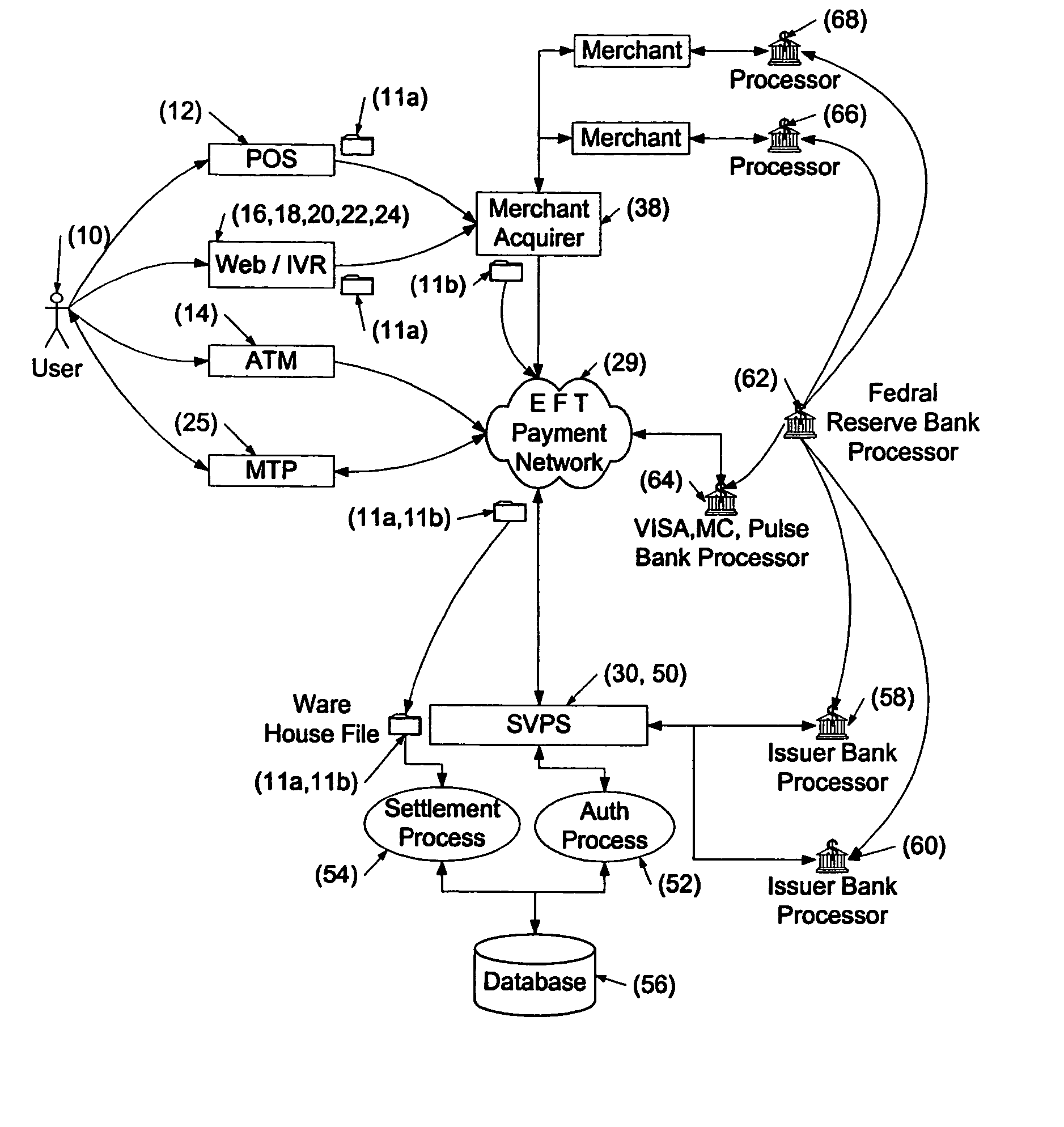

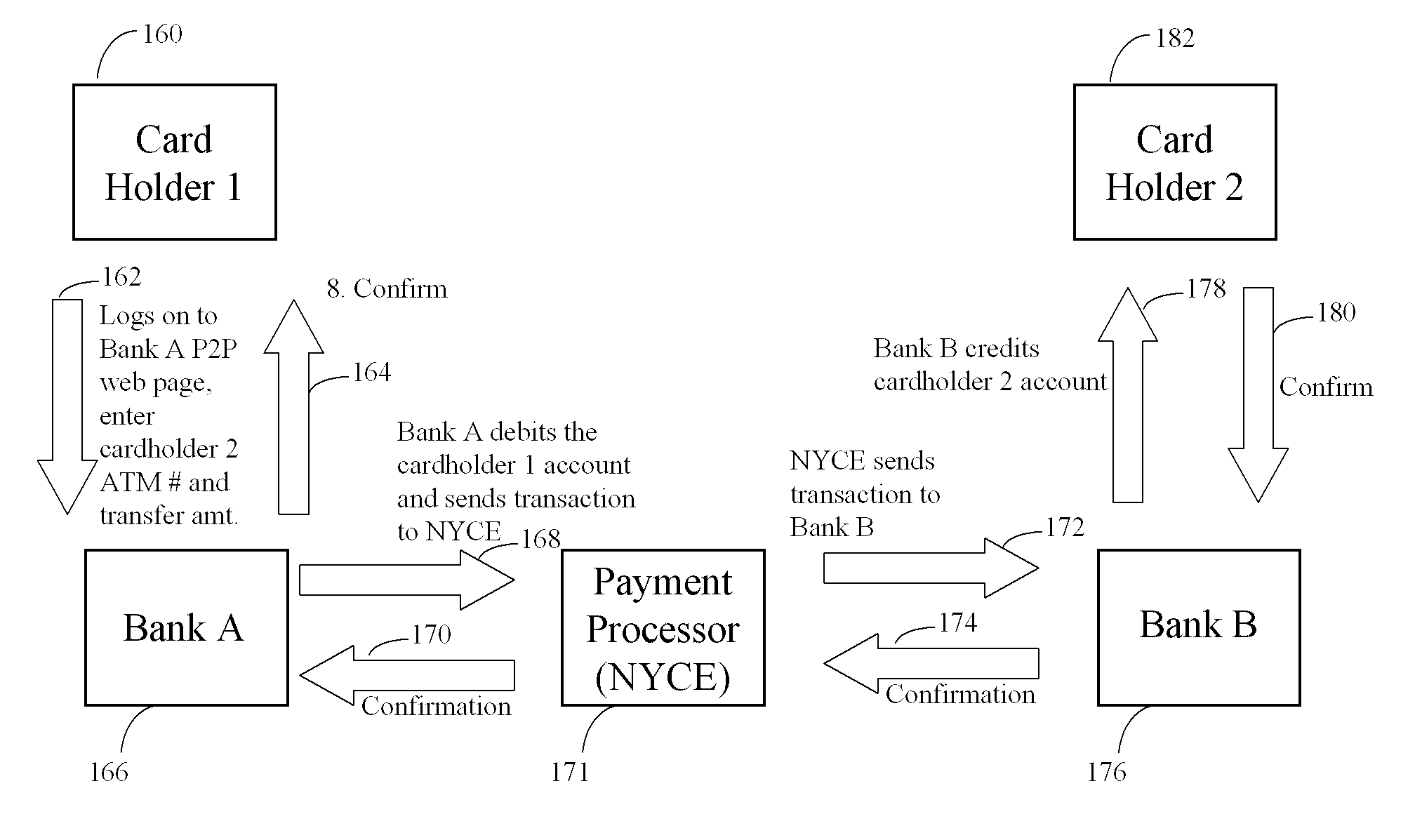

Method and system for facilitating electronic funds transactions

InactiveUS7104443B1Measurement is limitedReduce transaction costsComplete banking machinesFinanceInformation sharingMerchant account

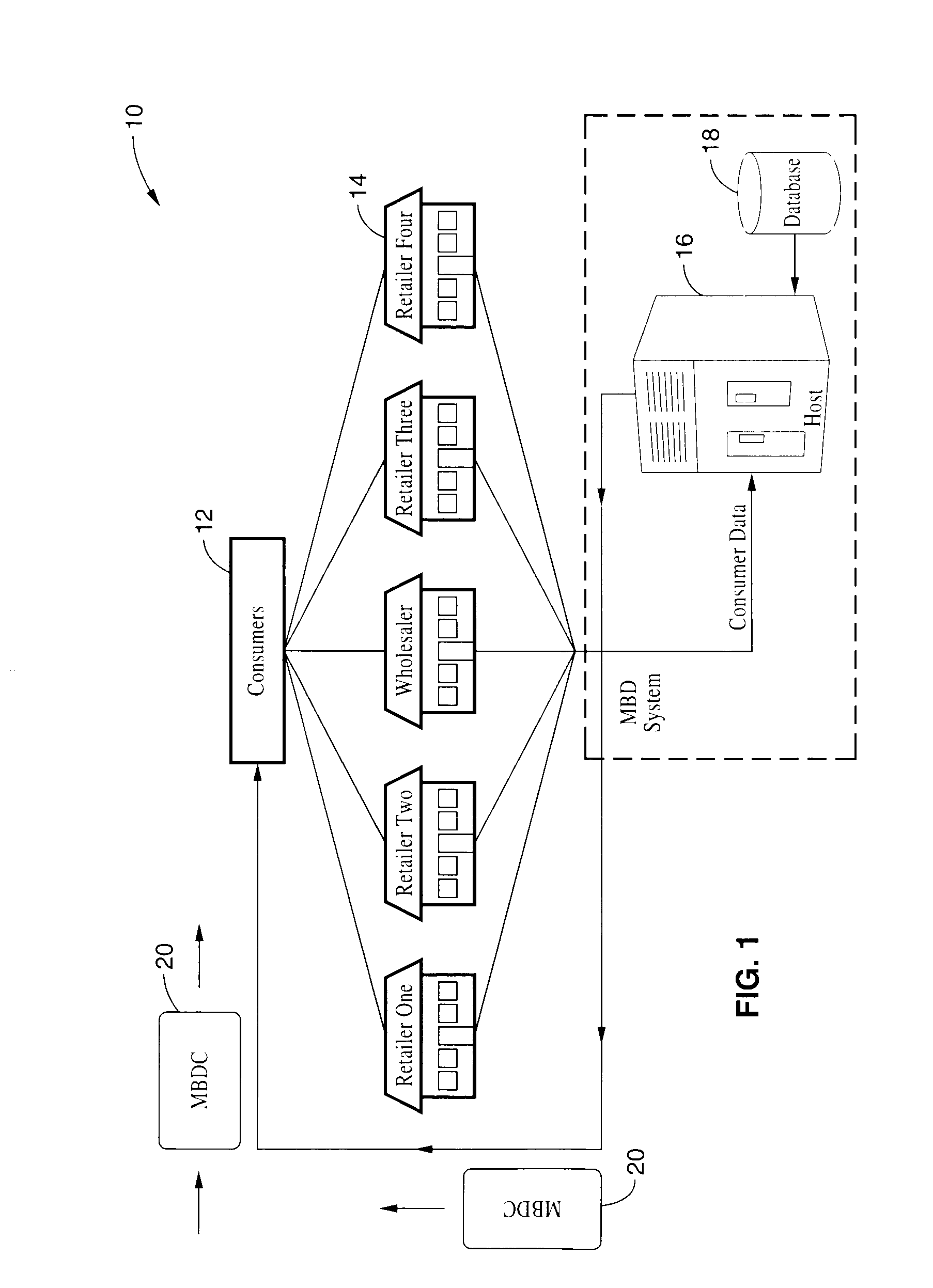

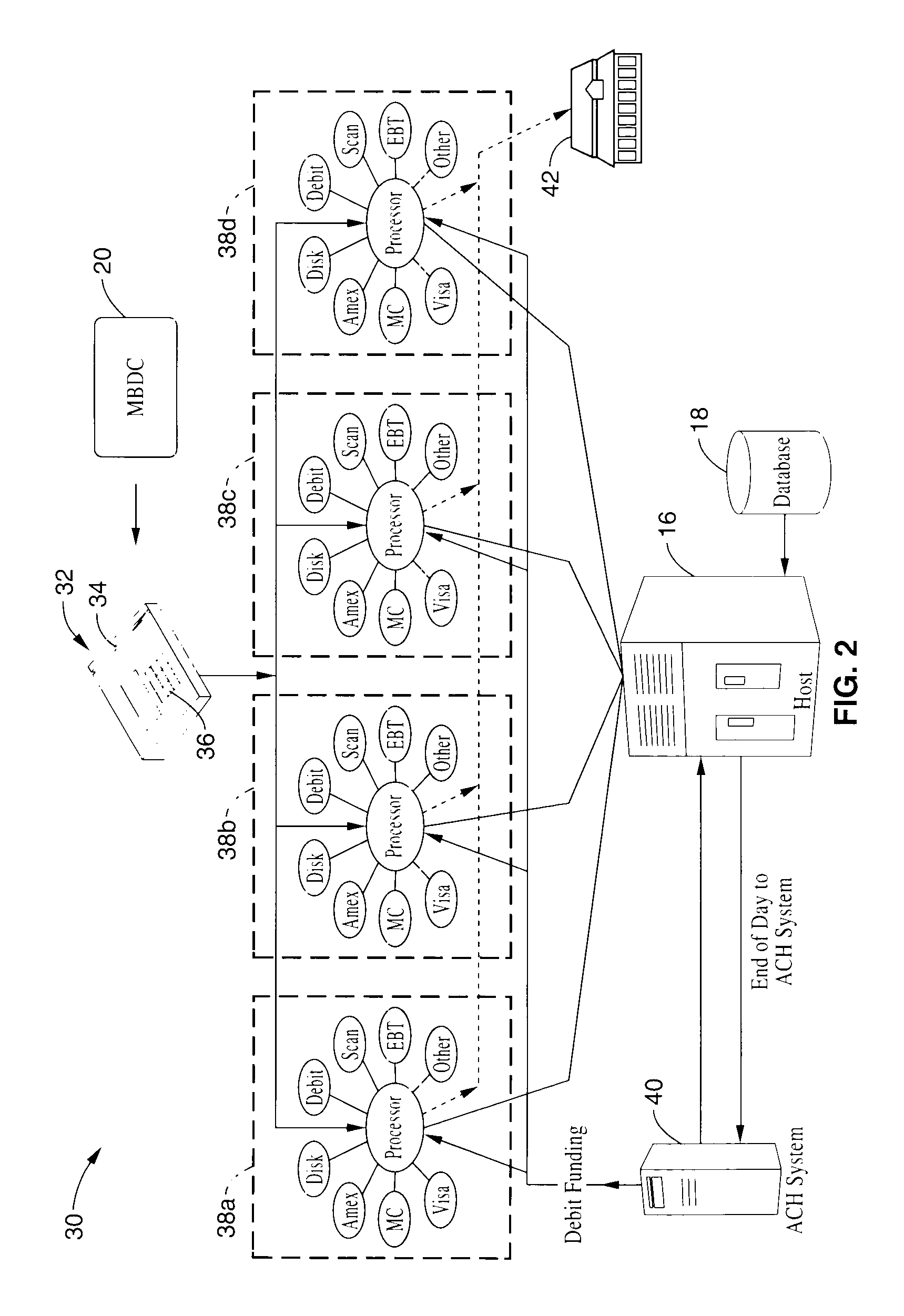

A method and system for executing electronic funds transactions using a merchant based debit (MBD) card in a merchant-centric system that provides for reduced fees to acquiring merchants and remitting a portion of the collected fees to issuing merchants. The system also preferably provides information sharing on consumer transactions with merchants to facilitate consumer based incentive programs and the like. The system operates over conventional card processing infrastructure and utilizes the ACH network, or equivalent, to settle the transaction from a consumer checking account, or a merchant account in the case of a prepaid MBD card. Using the system, merchants may elect to qualify customers based on their own criterion. A portion of the interchange fee is distributed to the issuing merchant associated transaction executed using the merchant based debit card. Embodiments are described for prepaid, fixed value, programmable, and refillable, forms of merchant based debit cards.

Owner:KIOBA PROCESSING LLC

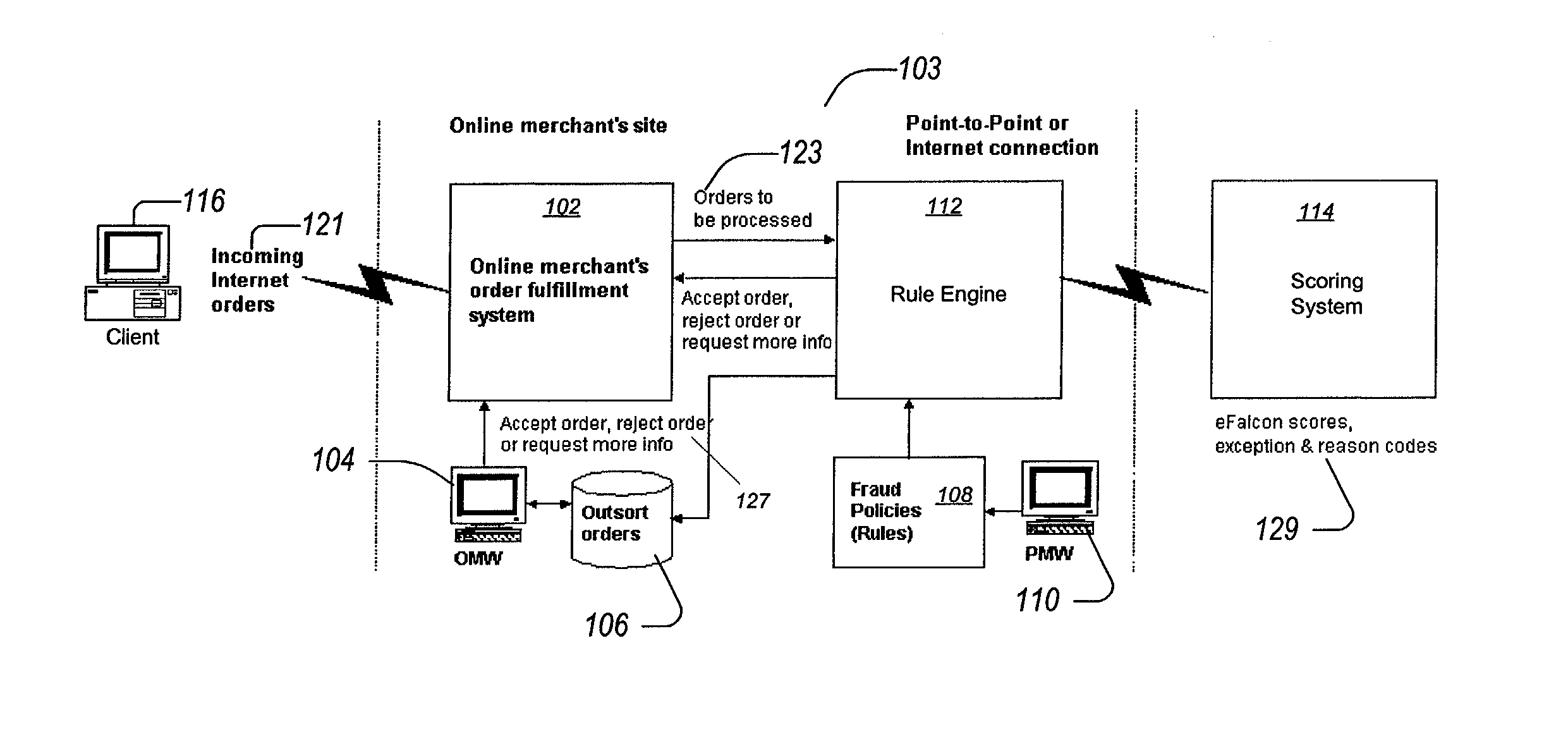

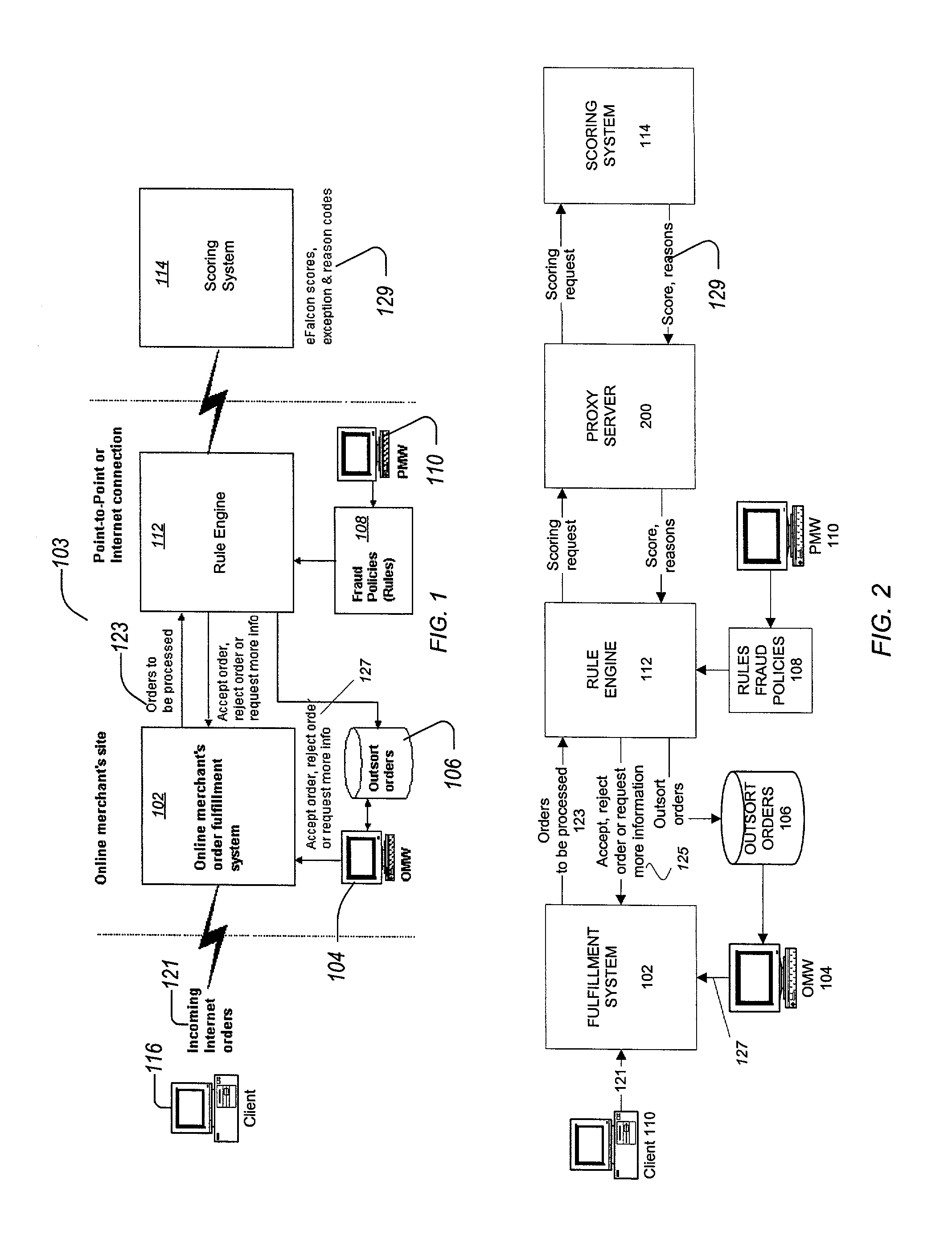

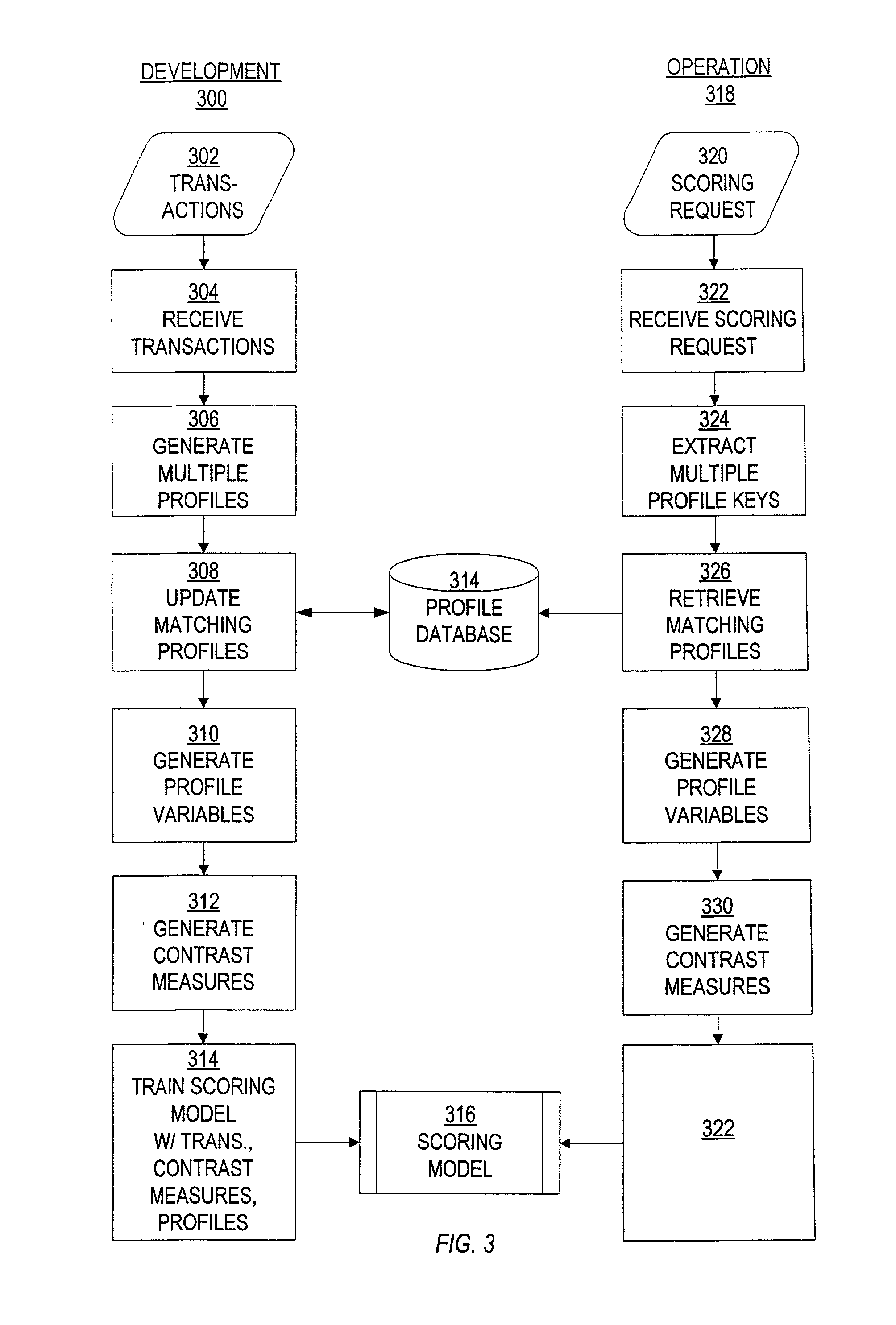

Identification and management of fraudulent credit/debit card purchases at merchant ecommerce sites

ActiveUS7263506B2Reduce exposureFinanceBuying/selling/leasing transactionsE-commerceFinancial transaction

Transaction processing of online transactions at merchant sites determines the likelihood that such transactions are fraudulent, accounting for unreliable fields of a transaction order, which fields do not reliably identify a purchaser. A scoring server using statistical model uses multiple profiles associated with key fields, along with weights to indicate the degree to which the profiles identify the purchaser of the transaction.

Owner:FAIR ISAAC & CO INC

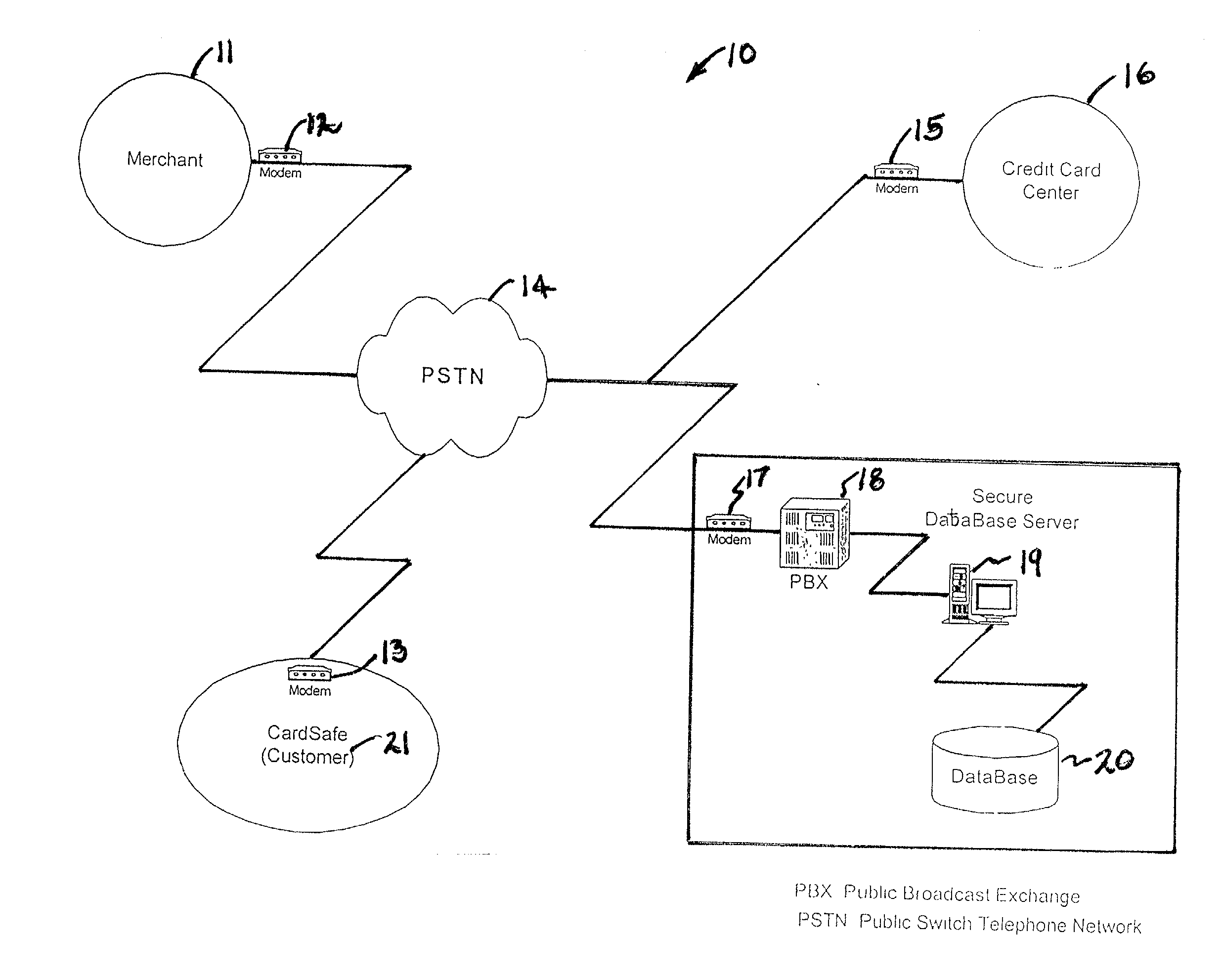

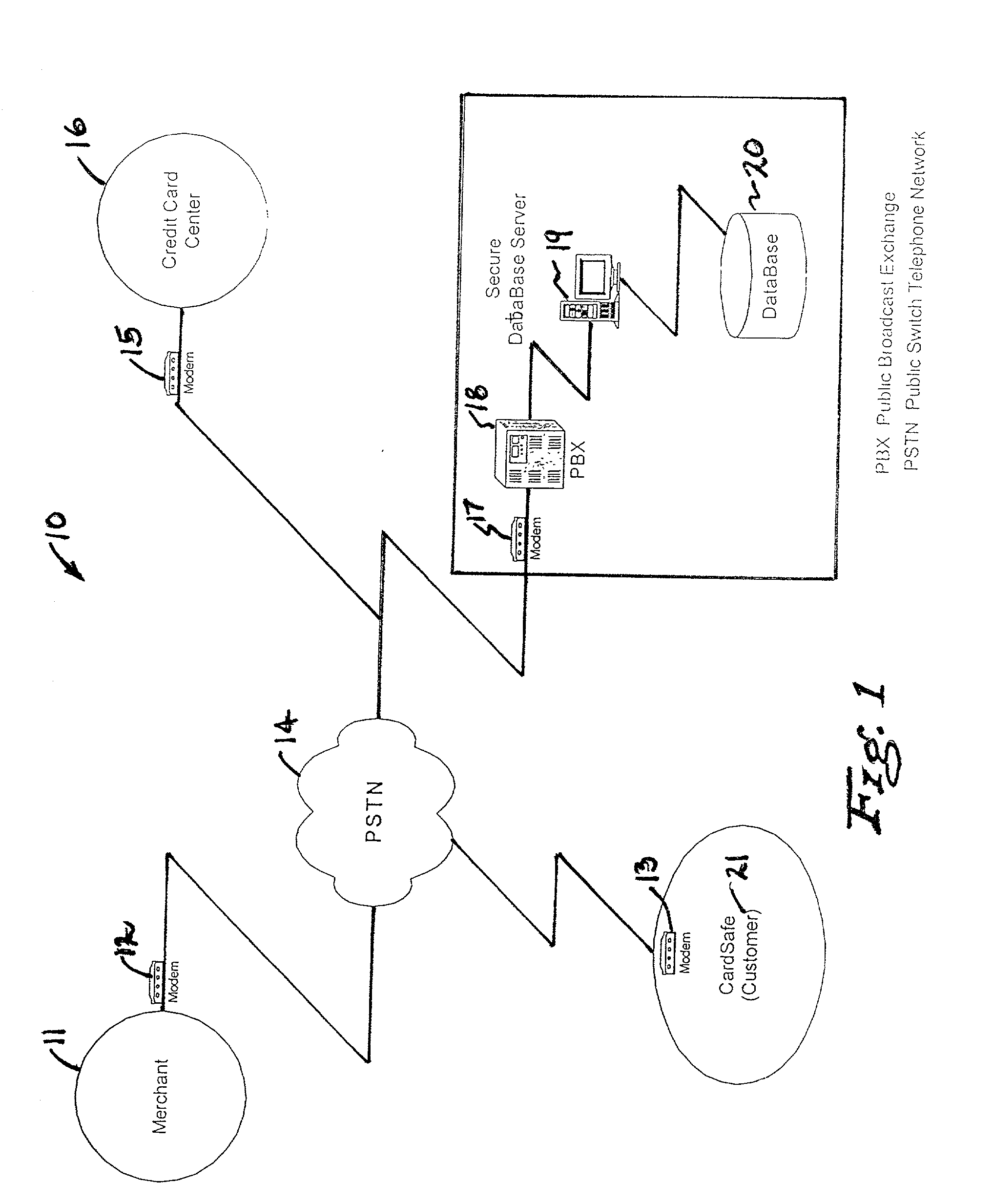

Method and apparatus for verification/authorization by credit or debit card owner of use of card concurrently with merchant transaction

A method and apparatus for protecting against the unauthorized use of a credit card called CardSafe(TM) allows the credit card holder to finally approve any credit card transaction. When a credit card is used at a remote merchant's terminal, the credit card company is notified of the transaction amount and the credit card account number. The named card holder is concurrently notified of the transaction by a wireless device, such as a telephone call, pager notification, or the like. Upon notification, the card holder can approve or disapprove of the credit card transaction. Unless approved or denied by the credit card holder, the transaction remains uncompleted. The approval or disapproval by the credit card holder can be accomplished in real time or on a pre-selected basis. An unauthorized person would not be able to complete a transaction The credit card owner can also deactivate the CardSafe(TM) system.

Owner:DURFIELD RICHARD C

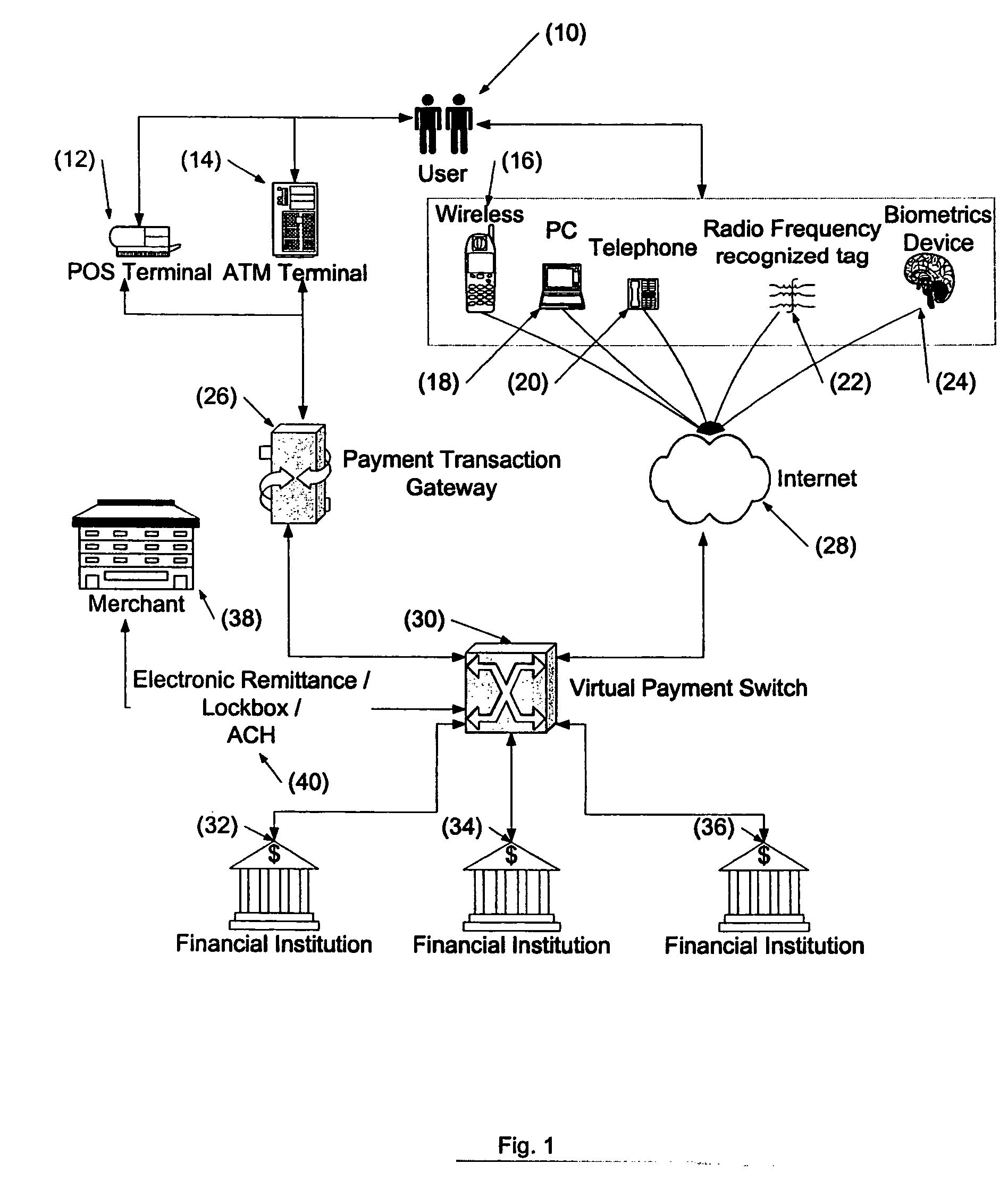

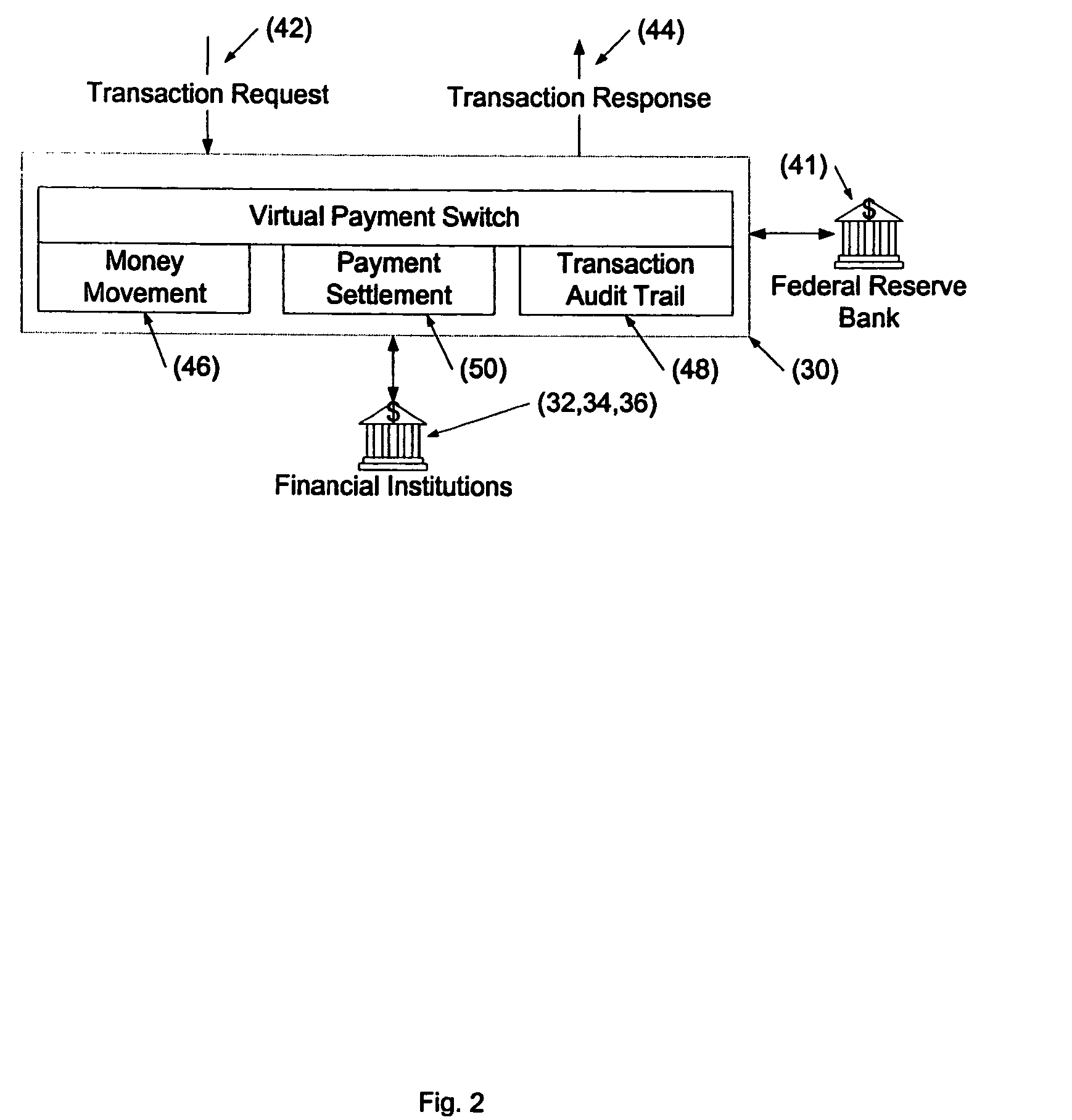

Persistent dynamic payment service

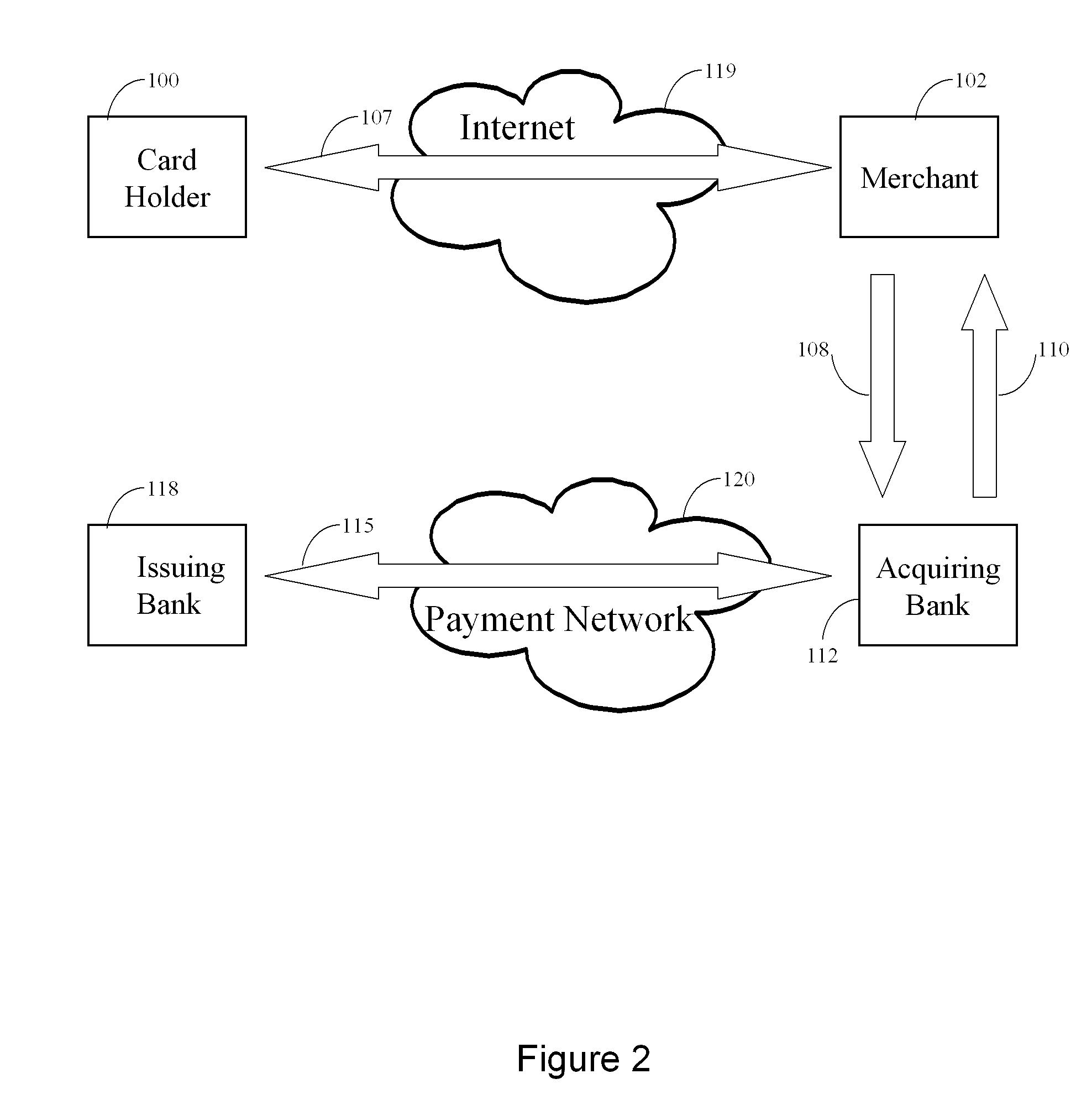

The invention comprises online methods, systems, and software for improving the processing of payments from financial accounts, particularly credit and debit card payments made from consumers to merchants in online transactions. The preferred embodiment of the invention involves inserting a trusted third party online service into the payment authorization process. The trusted third party authenticates the consumer and authorizes the proposed payment in a single integrated process conducted without the involvement of the merchant. The authentication of the consumer is accomplished over a persistent communication channel established with the consumer before a purchase is made. The authentication is done by verifying that the persistent channel is open when authorization is requested. Use of the third party services allows the consumer to avoid revealing his identity and credit card number to the merchant over a public network such as the Internet, while maintaining control of the transaction during the authorization process.

Owner:FISHER DOUGLAS C

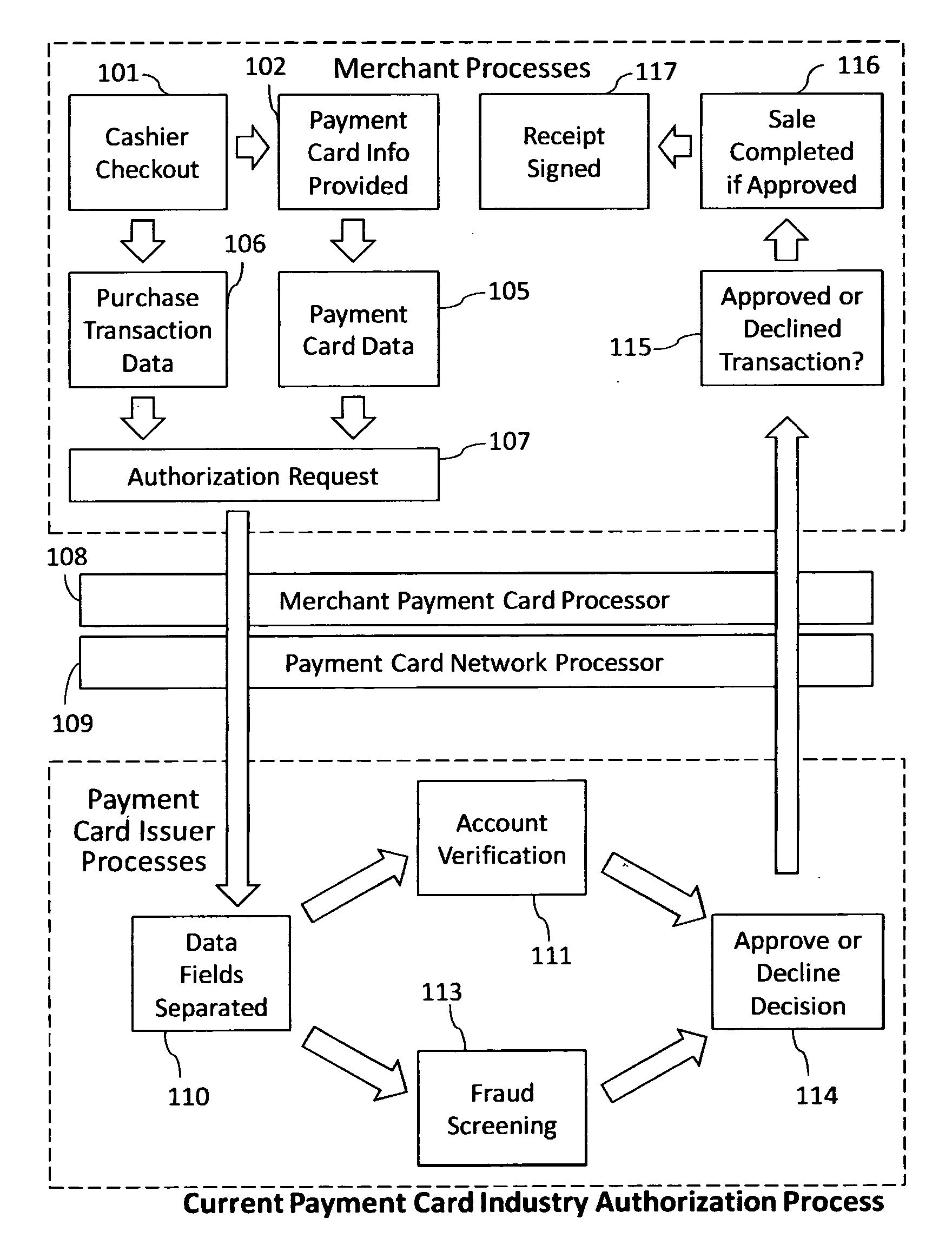

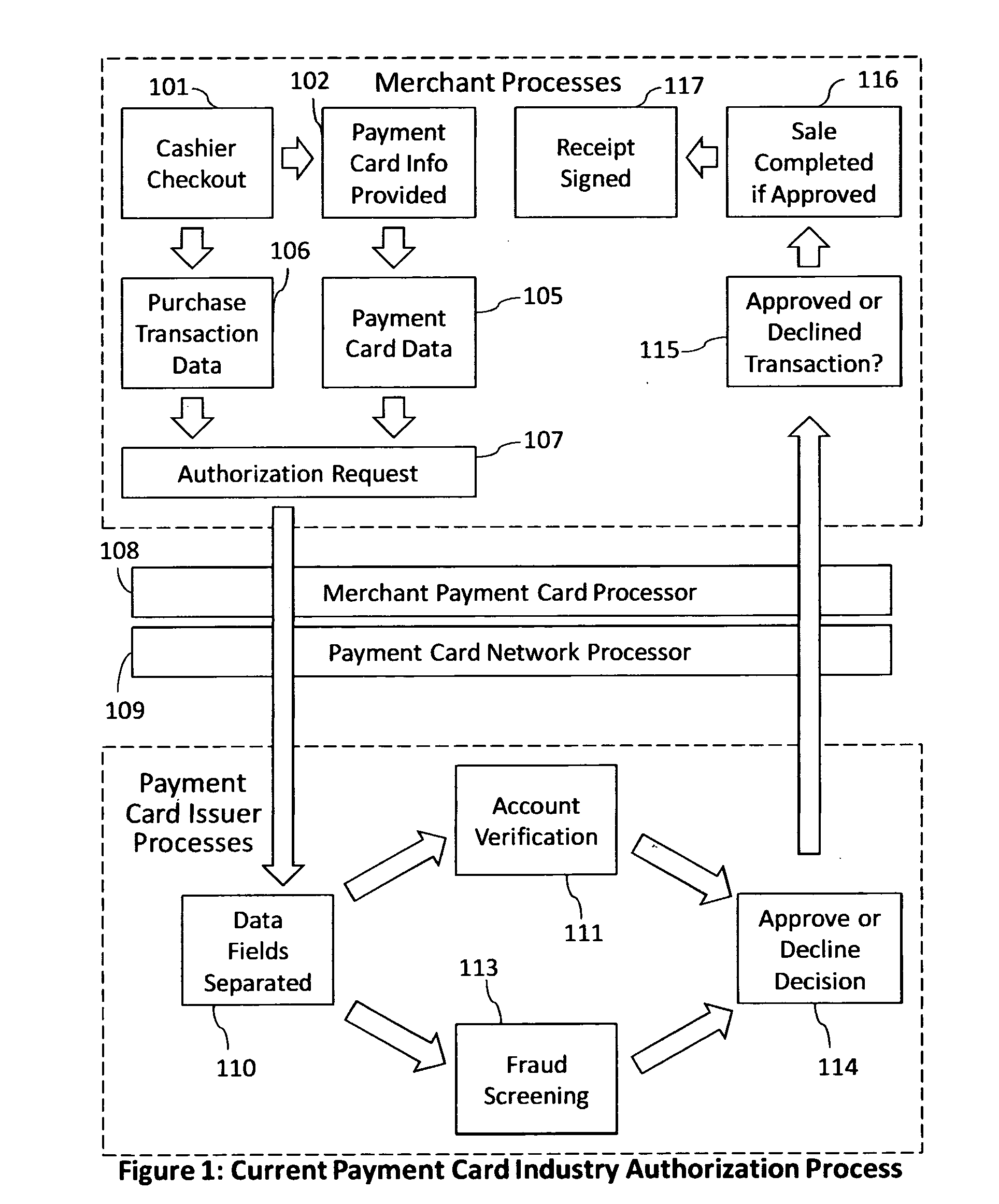

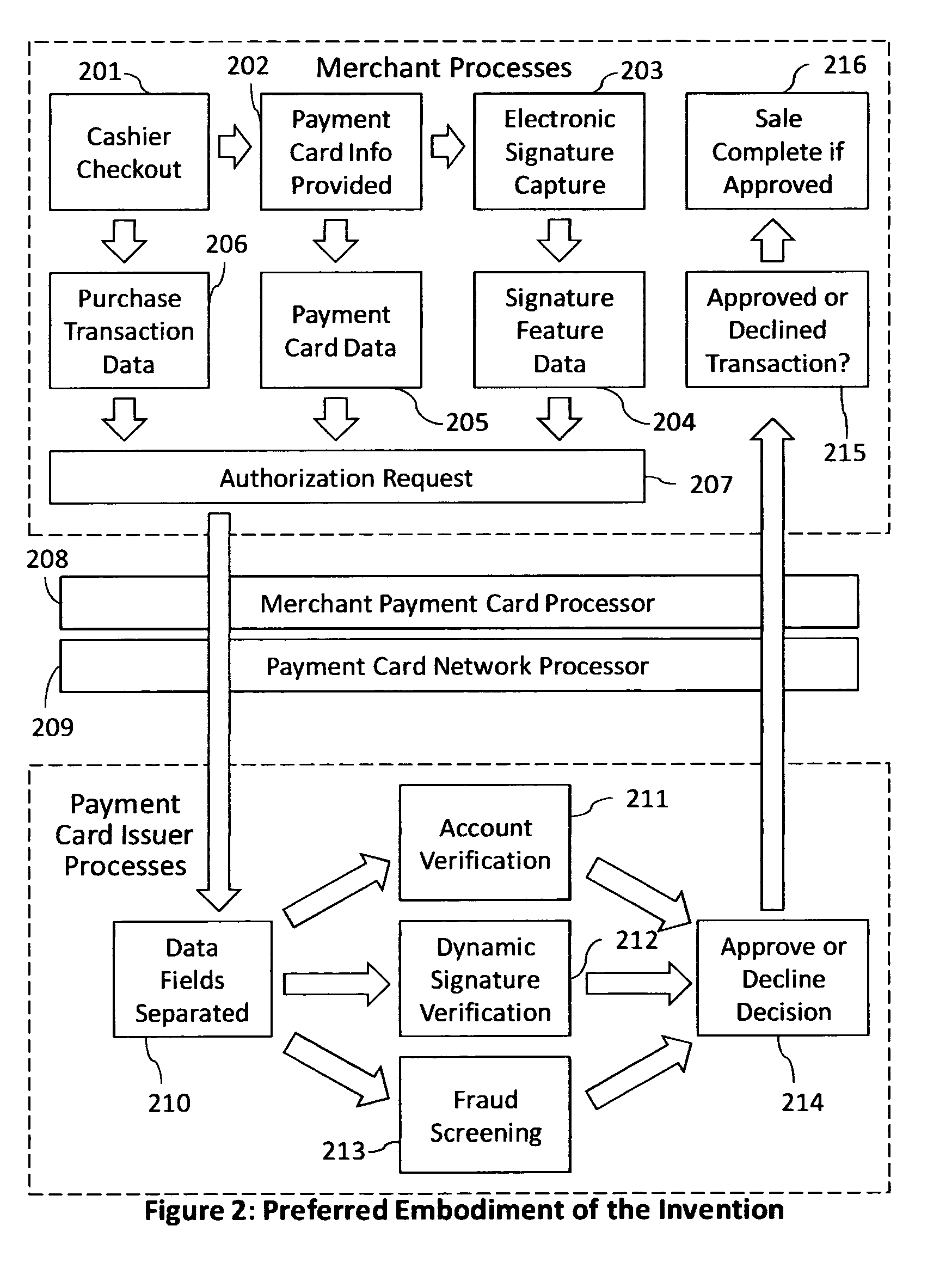

Reduction of transaction fraud through the use of automatic centralized signature/sign verification combined with credit and fraud scoring during real-time payment card authorization processes

InactiveUS20110238510A1Reduce payment card industry fraud lossReduce the amount of dataFinanceCharacter and pattern recognitionDigital signatureIdentity theft

A dynamic signature / sign biometric verification system for detecting and preventing fraudulent transactions is described. The system comprises remote digital signature / sign input devices, a means to extract spatial and temporal features from the signature, a means to transmit the signature / sign features along with customer identifier information to a centralized signature / sign verification authority, a means for combining signature / sign feature verification with other forms of fraud detection technology, and a means for transmitting the results of a signature / sign verification back to the remote location where the signature / sign was captured. The system was primarily developed for use in payment card industries (e.g. credit cards, debit cards) but has applicability to other centralized signature / sign verification applications such as Automated Teller Machine authorizations and other identity theft detection and monitoring services.

Owner:BIOCRYPT ACCESS LLC

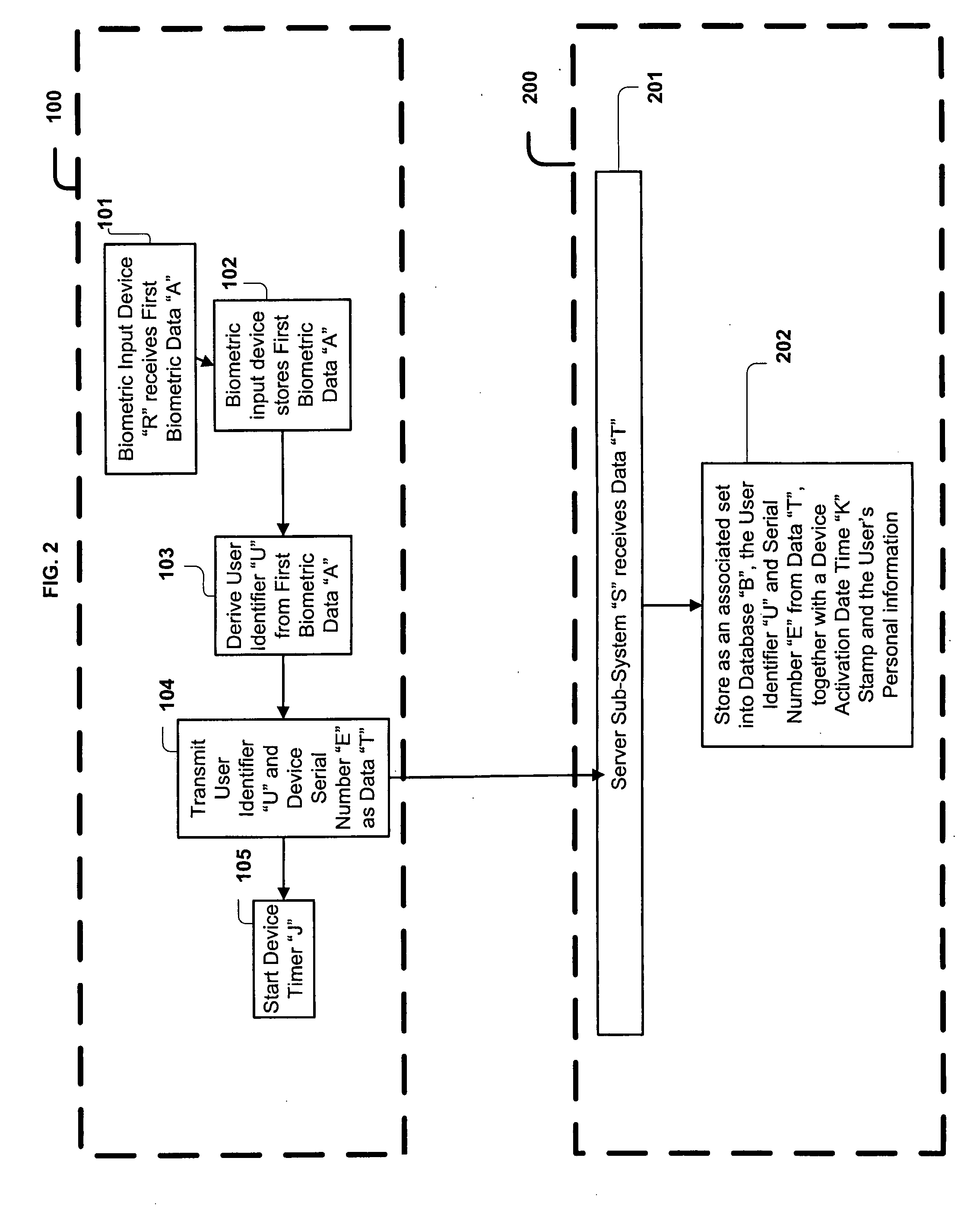

Method, system and computer readable medium for web site account and e-commerce management from a central location

InactiveUS7865414B2Minimizing activation timeMinimizing financial exposureAcutation objectsFinanceWeb sitePayment

A method, system, and computer readable medium for managing a financial transaction of a user at a merchant, including authenticating the user via a device of the user while the user is at the merchant; transmitting activation information for activating a reusable, pre-existing, unaltered and permanent credit or debit card account number of the user from the user device to a financial institution for processing financial transactions, while the user is authenticated; submitting a payment request including the account number to the financial institution from the merchant, while the account number is activated; and de-activating the account number after the payment request is processed by the financial institution. The financial institution only accepts and processes payment requests received from merchants while the account number is activated, and the financial institution declines payment requests while the account number is de-activated.

Owner:SLINGSHOT TECH LLC

Method, system and computer readable medium for web site account and e-commerce management from a central location

A method, system and computer readable medium for managing a user online financial transaction at a destination ecommerce web site using a credit or debit card account of the user, including a) transmitting an activation command to a financial institution processing financial transactions for activating the credit or debit card account of the user; b) submitting a charge request for the credit or debit card account to the financial institution via a destination e-commerce web site to which the user is logged in while the credit or debit card account is in the activated status; and c) transmitting a de-activation command to said financial institution for de-activating the credit or debit card account, wherein the financial institution only accepts and processes charge requests received from e-commerce web sites while the credit or debit card account is in the activated status and wherein the financial institution declines charge requests while said credit or debit card account is in the de-activated status, and wherein steps a) to c) are repeated at least once.

Owner:SLINGSHOT TECH LLC

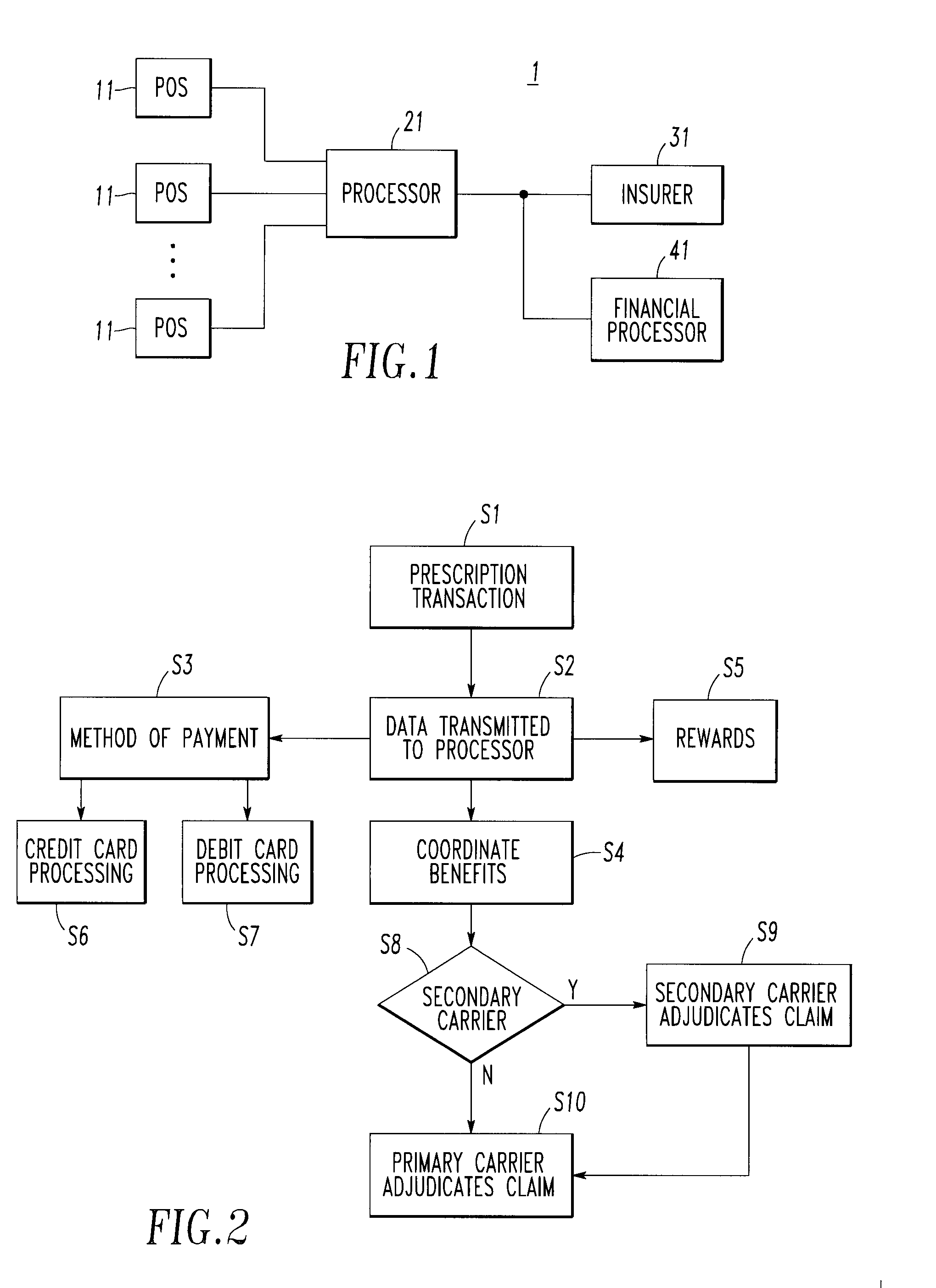

Integrated pharmaceutical accounts management system and method

InactiveUS20020002495A1Facilitate real-time adjudicationEasy to processHand manipulated computer devicesDrug and medicationsData warehouseDrug interaction

<heading lvl="0">Abstract of Disclosure< / heading> An integrated suite of services for consumers, service providers and manufacturers in the pharmaceutical industry is disclosed. The present invention utilizes one or more of the NCPDP standard formats and adopts the switch for an integrated system of, for example, instant adjudication of prescriptions, consumer data warehousing and / or incentive rewards for the consumer. A participating consumer with one card, can instantly purchase pharmaceuticals and charge the transaction to a credit card and earn and apply savings dollars redeemable for pharmaceutical purchases. For a participating service provider, instant adjudication and instant validation of consumer eligibility can be performed. Moreover, a service provider may receive messages related to the patient's medications. Significantly, data is recorded for consumers even when consumers make the pharmaceutical purchase with cash. The system includes a unique card issued to participating consumers. The card is adapted to encode conventional credit or debit card information specific to the participating consumer so that the consumer can consummate a transaction for the purchase of pharmaceuticals without possession of an additional credit card. The system further includes a host processor coupled to the point of sale at the service provider through a leased line or public switch network or the like. When a customer performs a pharmaceutical transaction at the point of sale of the service provider, the host processor coordinates any benefits and data with other prescription benefit management systems through messages transmitted and received from any primary or secondary carrier systems. The host processor further is adapted to facilitate real-time adjudication of claims and checks for any dangerous drug-to-drug interactions. The host processor additionally facilitates any financial processing including the accumulation and redemption of any bonus dollars earned by the consumer. Furthermore, since the card used by the consumer can be encoded with credit or debit card information, the host processor determines the desired payment method and performs the actual financial transaction. Even if the transaction at the point of sale is a cash purchase, the consumer may desire to use his unique card for the accrual of bonus dollars. Therefore, data concerning the transaction (i.e., pharmacy number, prescription number, etc.) can be recorded even for transactions conducted with cash.

Owner:NPAX

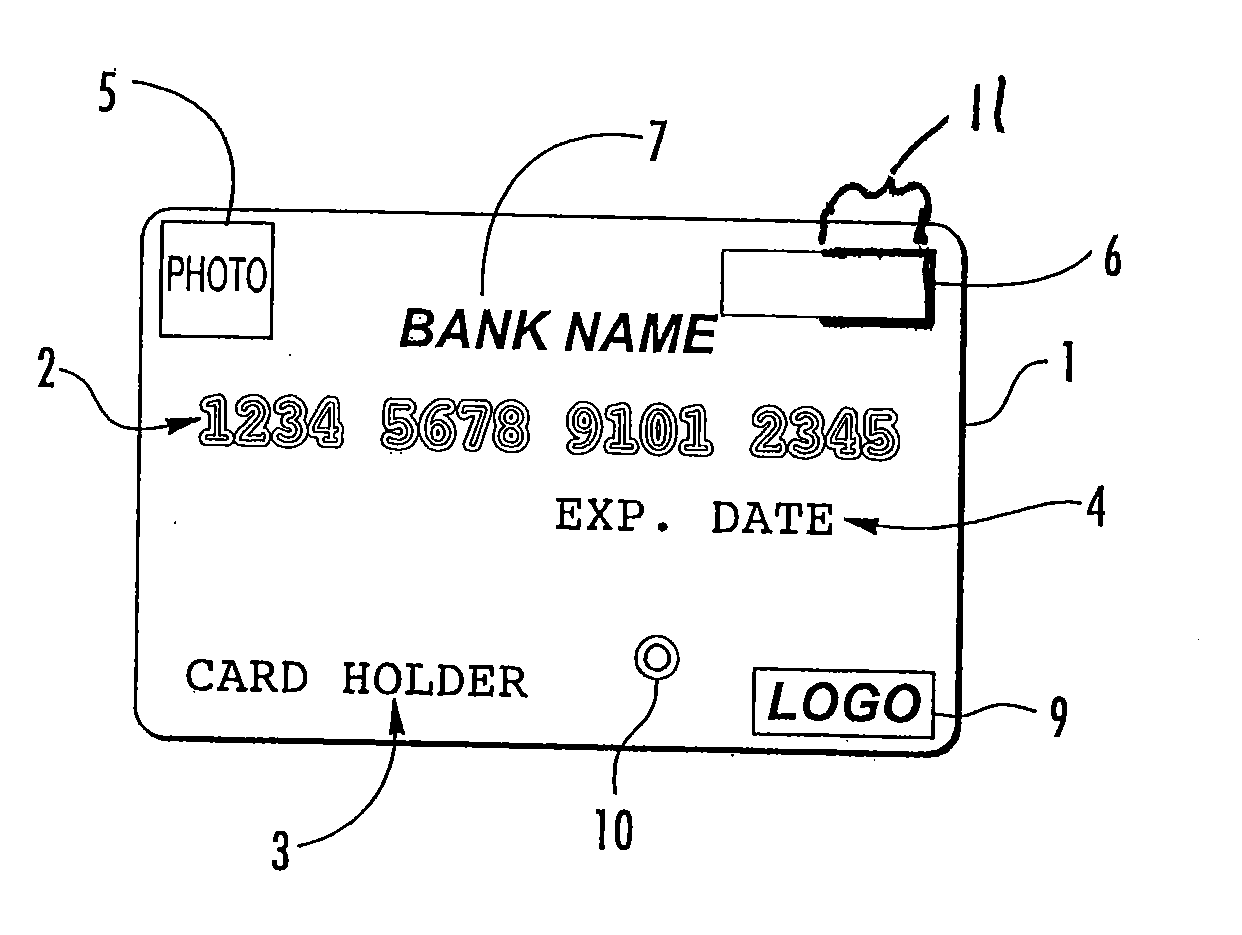

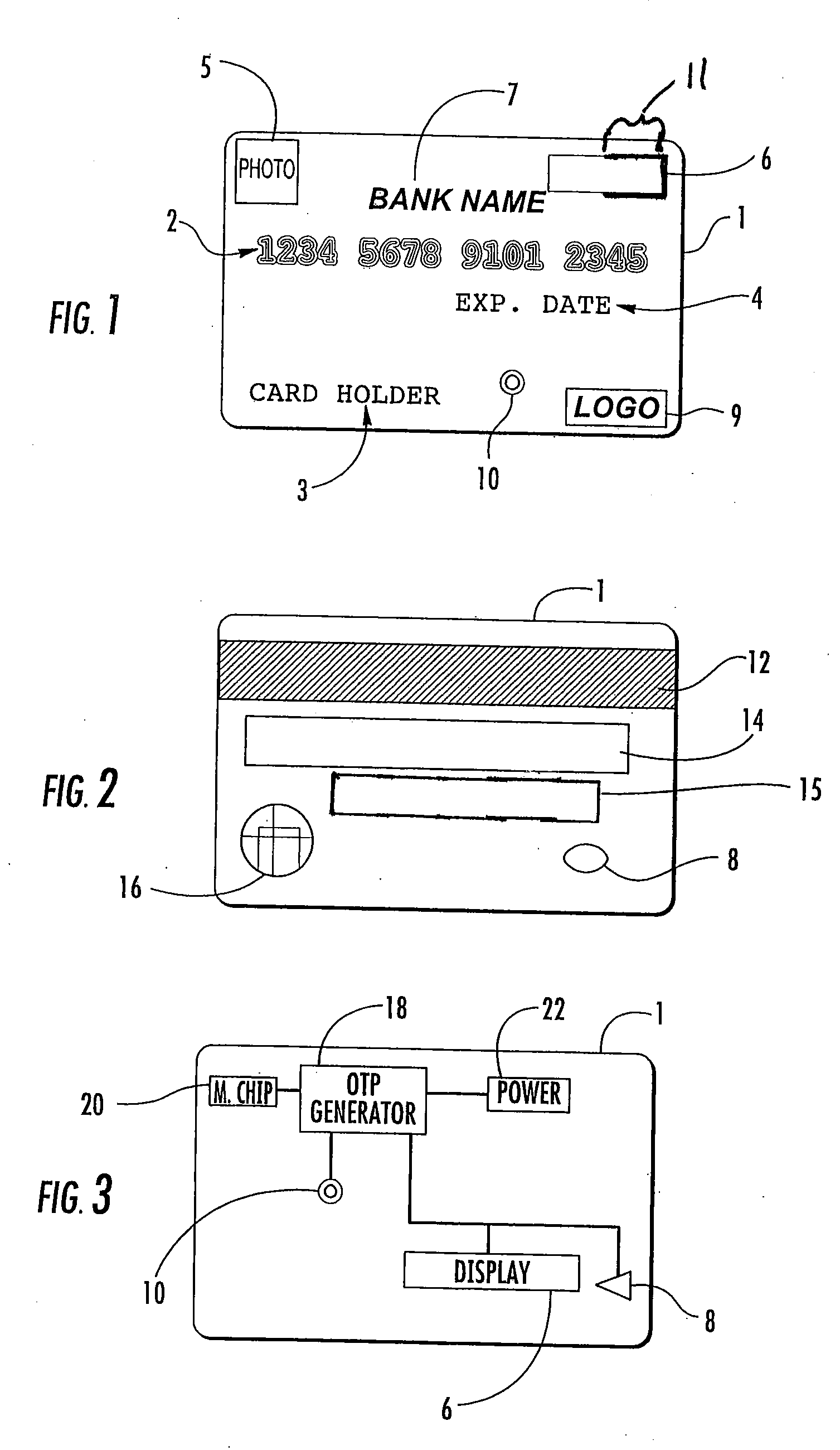

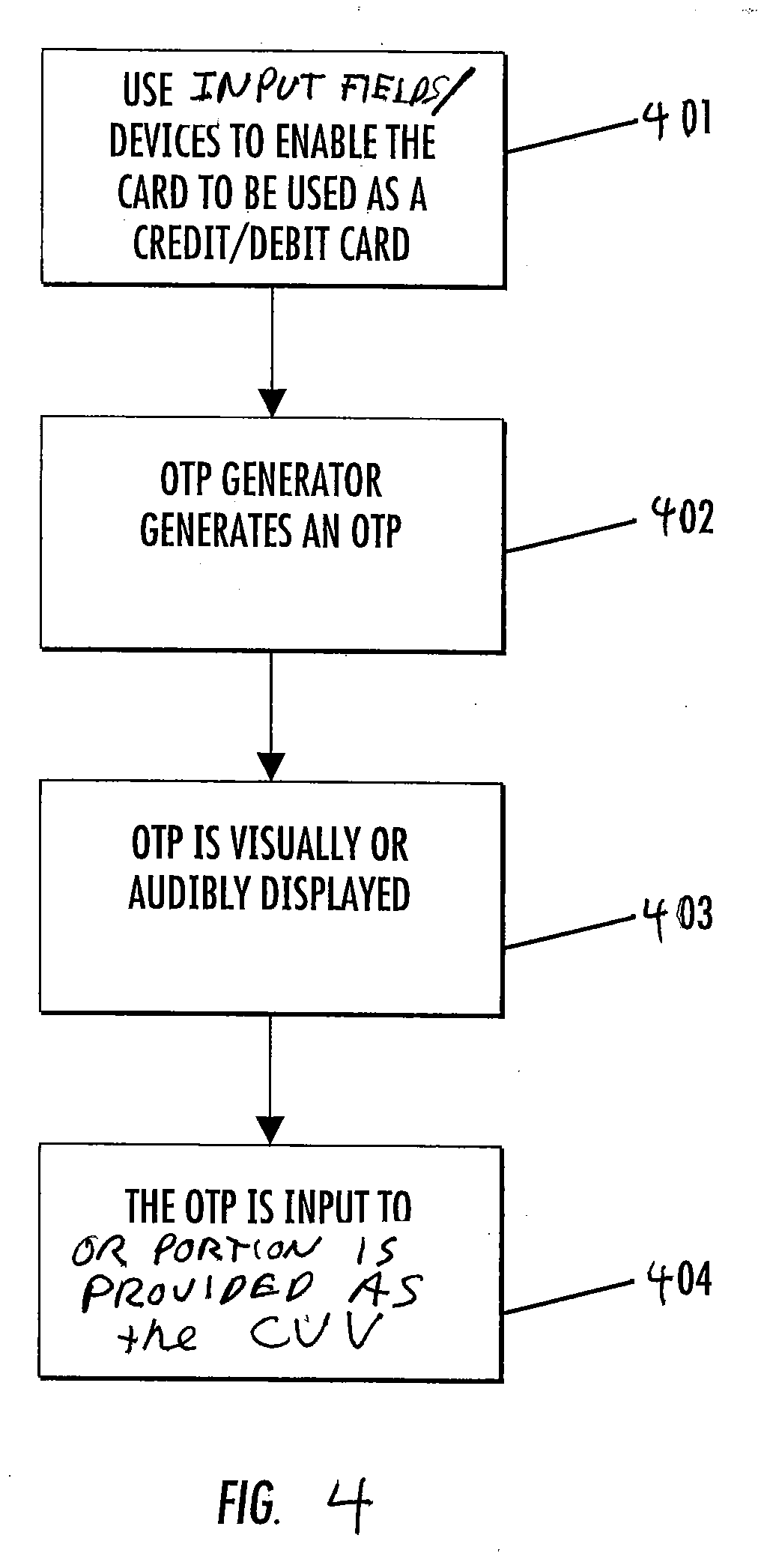

Method and apparatus for using at least a portion of a one-time password as a dynamic card verification value

Method and apparatus for using at least a portion of a one-time password as a dynamic card verification value (CVV) are disclosed. A credit / debit card is able to generate a dynamic card verification value (CVV). Such a card may also include an indication that the dynamic CVV is to be used as a security code for purchasing or other transactions. A card-based financial transaction can be authorized in accordance with the use of a dynamic CVV by receiving a transaction authorization request for a specific credit / debit card, wherein the transaction authorization request includes a dynamic CVV. The dynamic CVV can be compared to at least a portion of a one-time password generated for the specific credit / debit card, and a transaction authorization can be sent to the merchant or vendor when the dynamic CVV matches all or a portion of the one-time password.

Owner:BANK OF AMERICA CORP

System, Method, and Apparatus for Preventing Identity Fraud Associated With Payment and Identity Cards

InactiveUS20070291995A1Easy and efficient to manufactureDurable and reliable constructionCharacter and pattern recognitionInternal/peripheral component protectionIdentity fraudDriver's license

The system, method, and apparatus of the present invention, address the problem of identity theft associated with the use of payment cards such as credit and debit cards, as well as identity theft associated with the use of identity cards such as driver's licenses and social security cards. An apparatus including a biometric input component that authenticates a system user is disclosed herein. Upon authentication, a proxy account number and a time varying security code are generated and displayed on the apparatus. The dynamically generated number and security code are then used to validate the user's identity within the system. Furthermore, the system, method, and apparatus of the present invention can be used to consolidate into one instrument, several payment and identity instruments.

Owner:RIVERA PAUL G

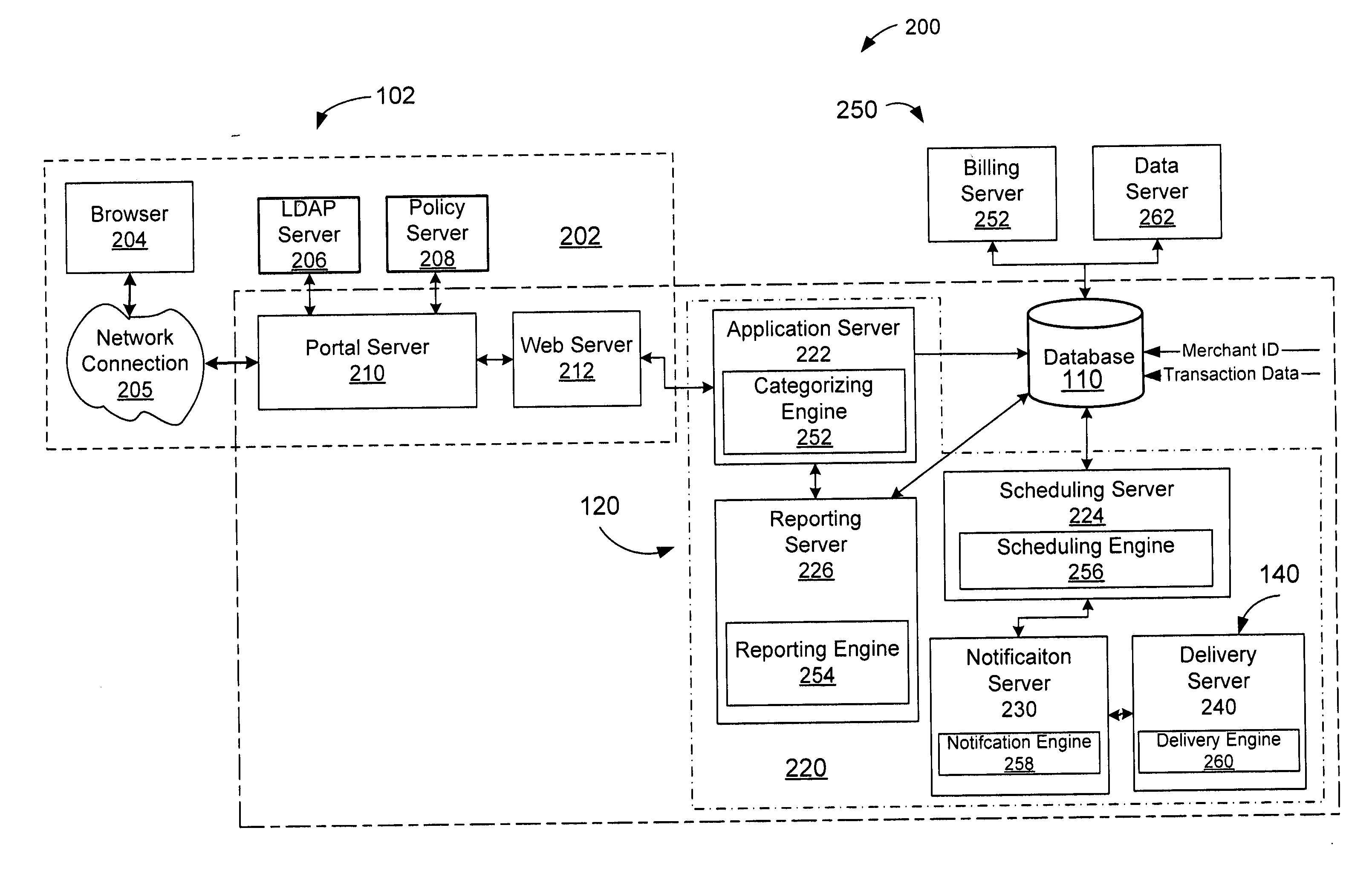

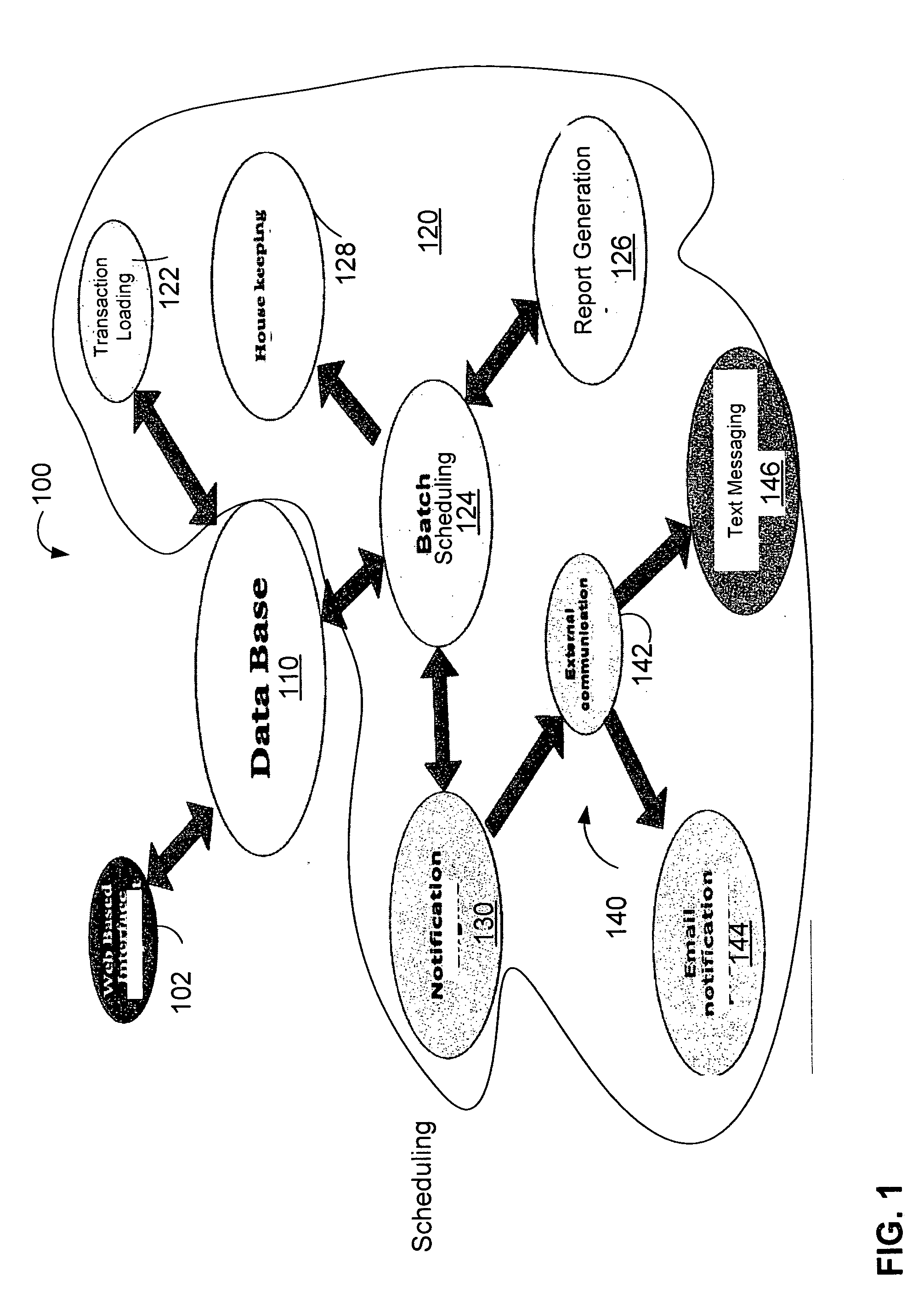

Method and system for manipulating purchase information

A method and system for generating customized categories for financial transaction reports associated with portable consumer devices is disclosed. In one embodiment, a financial transaction reporting system is configured to track and output a user's financial transactions associated with the user's portable consumer device for both credit and debit transactions. The system and method automatically assigns financial transactions associated with their credit and / or debit cards with a transaction category such as business, travel, meals and entertainment, etc. based on predefined and / or user-defined merchant categorization codes. The user on a server is provided with the capability to customize the merchant categorization codes and the content of reports derived from the user's financial transactions. The user may customize the report content to specific transaction categories, sub-categories, and time periods.

Owner:VISA USA INC (US)

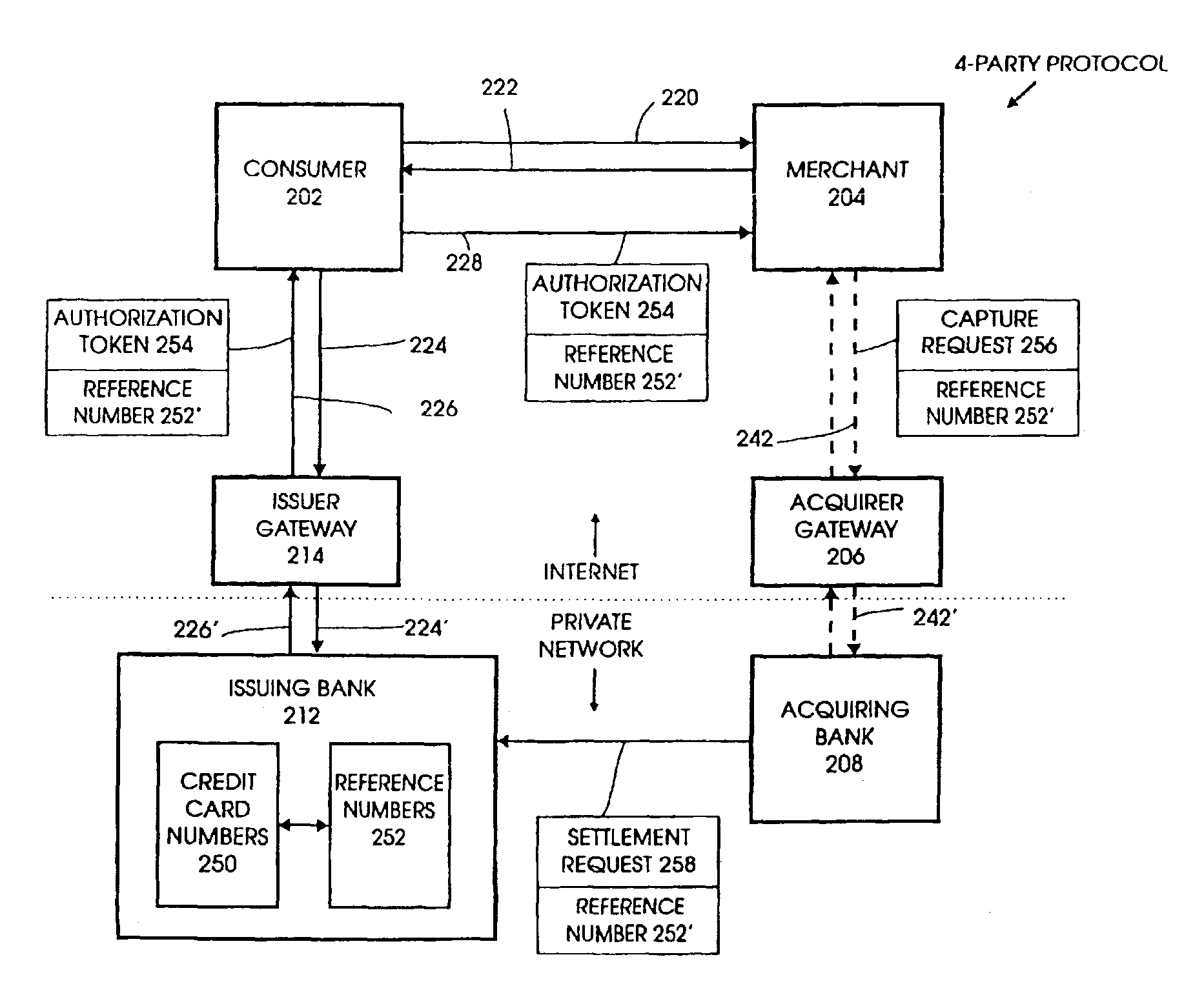

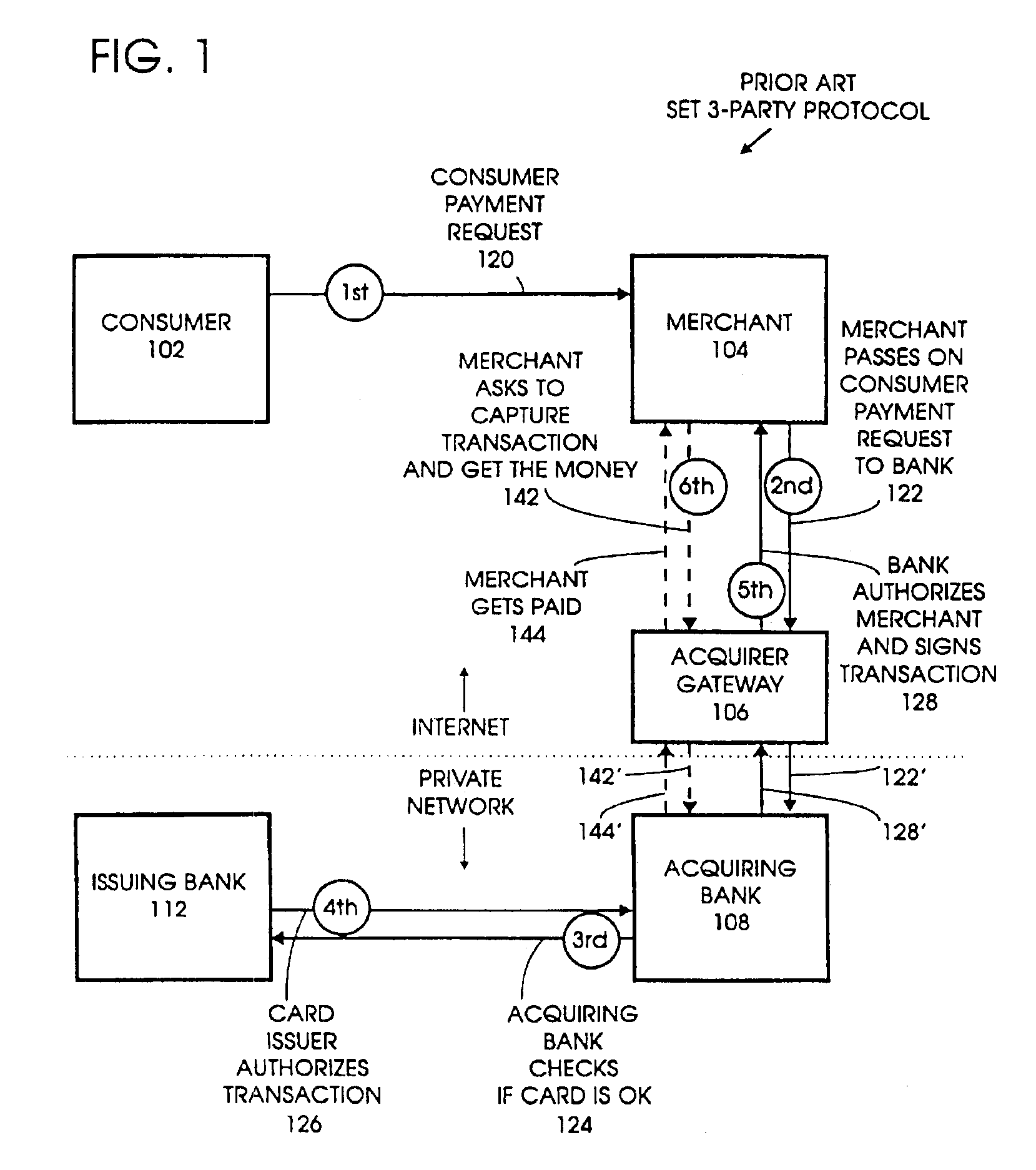

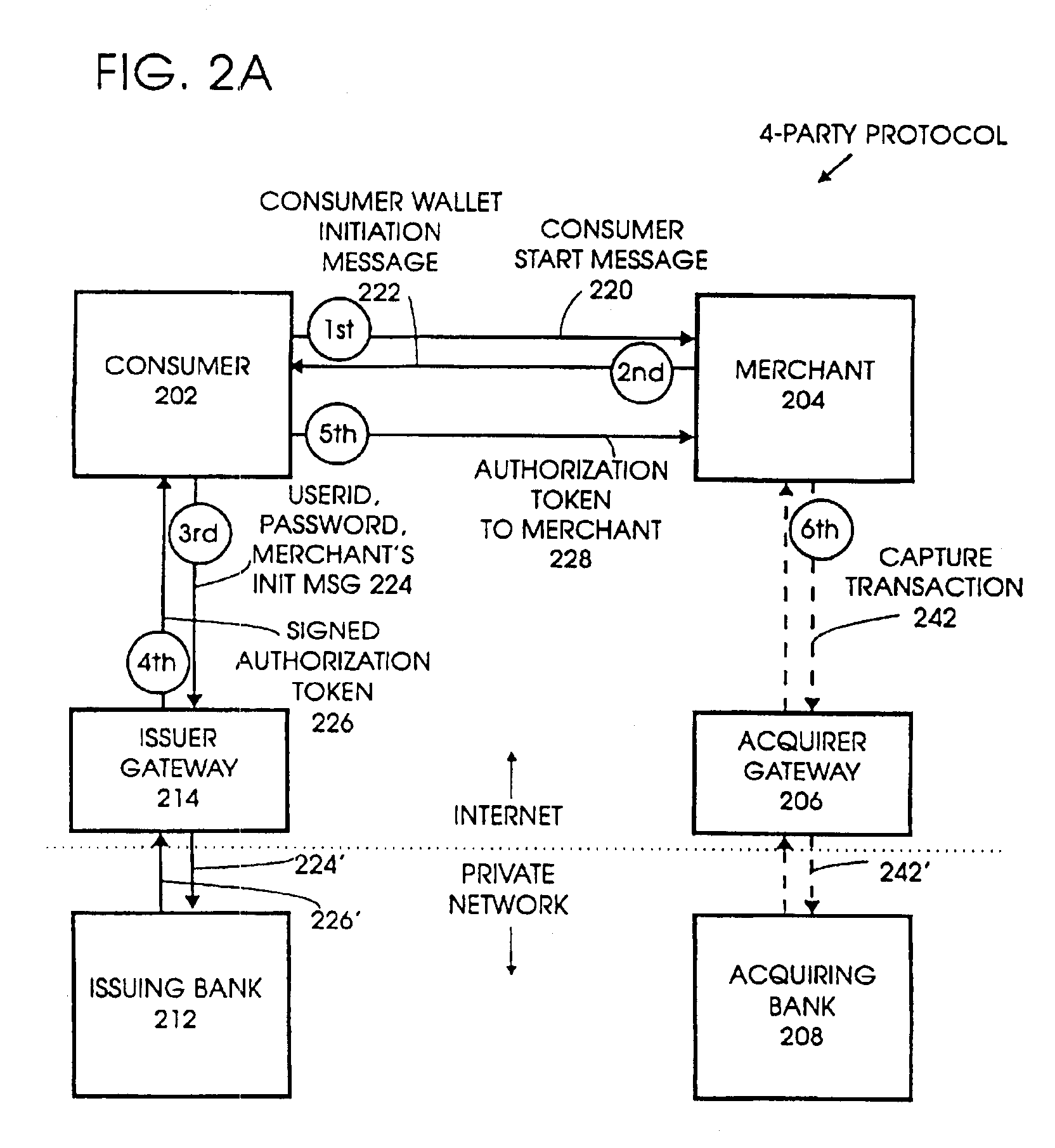

Four-party credit/debit payment protocol

InactiveUSRE40444E1Good effectReduce complexityUser identity/authority verificationSecret communicationE-commerceAuthorization

A method, system, program, and method of doing business are disclosed for electronic commerce that includes the feature of a “thin” consumer's wallet by providing issuers with an active role in each payment. This is achieved by adding an issuer gateway and moving the credit / debit card authorization function from the merchant to the issuer. This enables an issuer to independently choose alternate authentication mechanisms without changing the acquirer gateway. It also results in a significant reduction in complexity, thereby improving the ease of implementation and overall performance.

Owner:PAYPAL INC

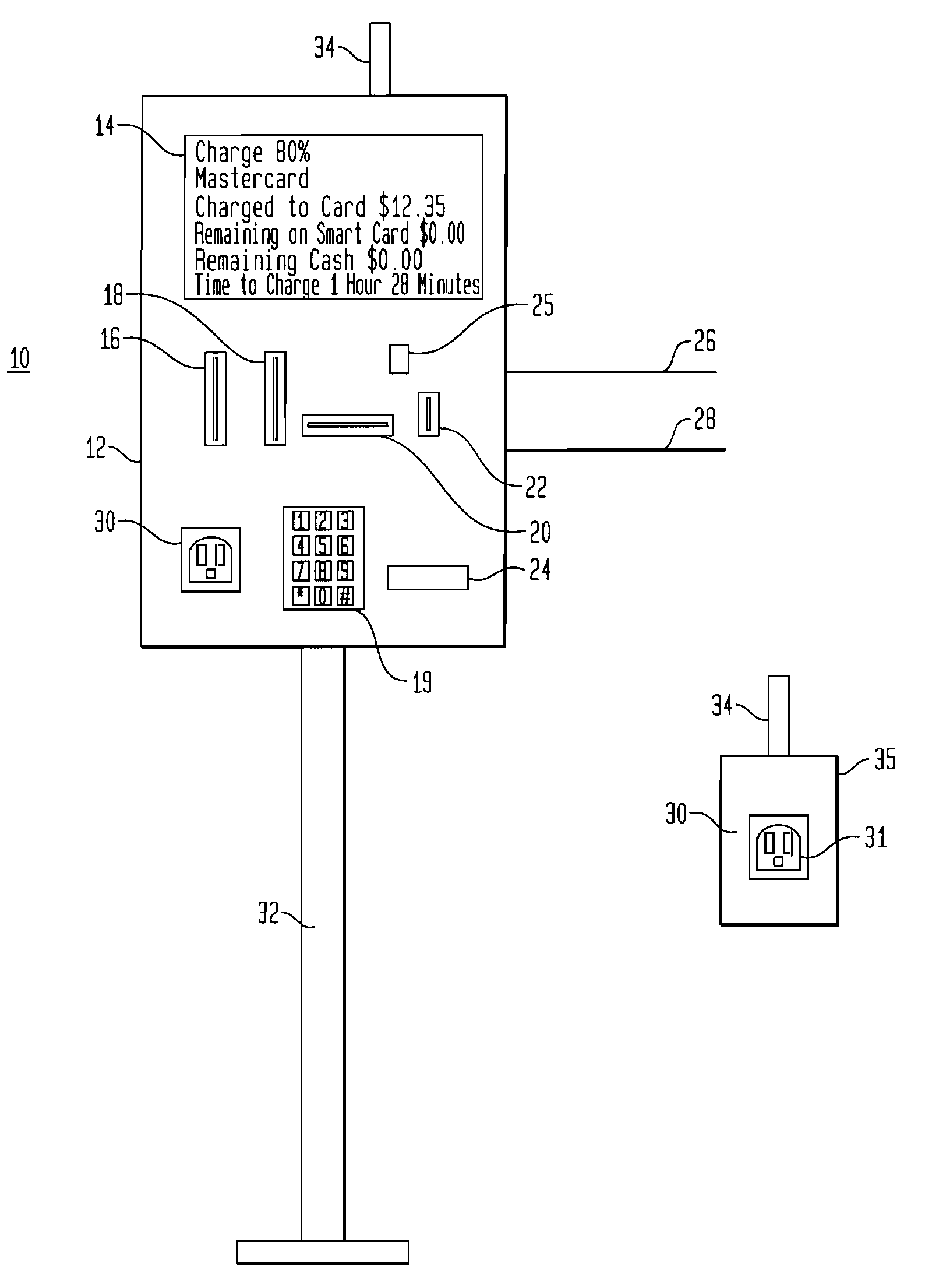

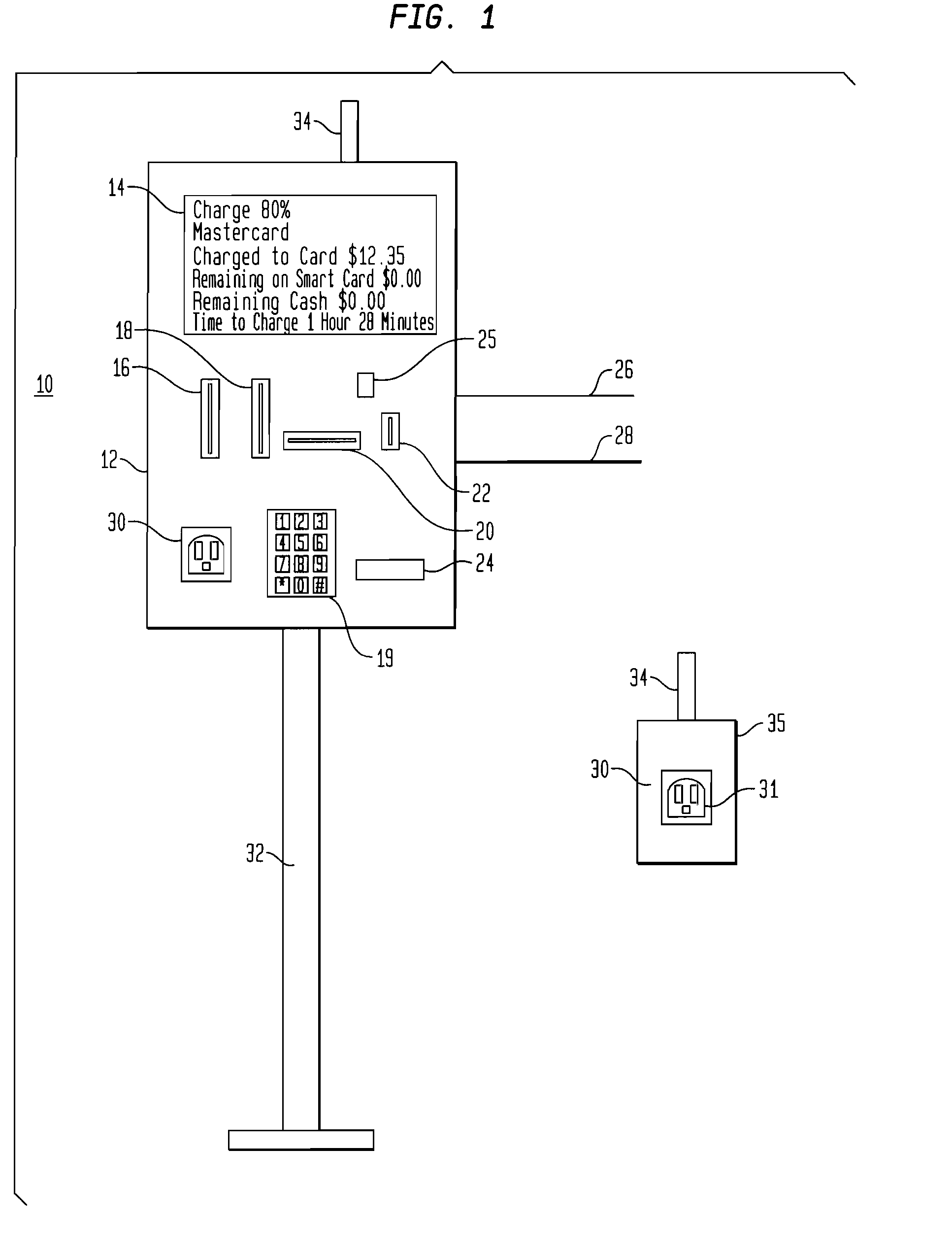

Charging station for electric and plug-in hybrid vehicles

This invention is a pay charging station for electric and plugin hybrid vehicles. A vehicle parks at a space with the charging station and uses a credit card, debit card, cash, smart card or network connection to a database like EZ-Pass to pay for the space and the electricity. The station automatically charges the vehicle as long as it is connected to the station. The station automatically stops charging when the vehicle is fully charged. The customer only pays for the space and the electricity consumed. If the charging circuit is broken the customer must reinsert the smart card or credit card to restart charging. Sufficient funds are removed from the payment method on initiation of charging. Any money not used for charging is returned to the funding account upon the user reinserting the smart card, credit card or debit card, or cash change is returned if cash was the method of payment.

Owner:PALUSZEK MICHAEL ADAM +3

Image-Based Payment Medium

InactiveUS20090182634A1Appropriate balanceFinanceSpecial service for subscribersBarcode readerComputer science

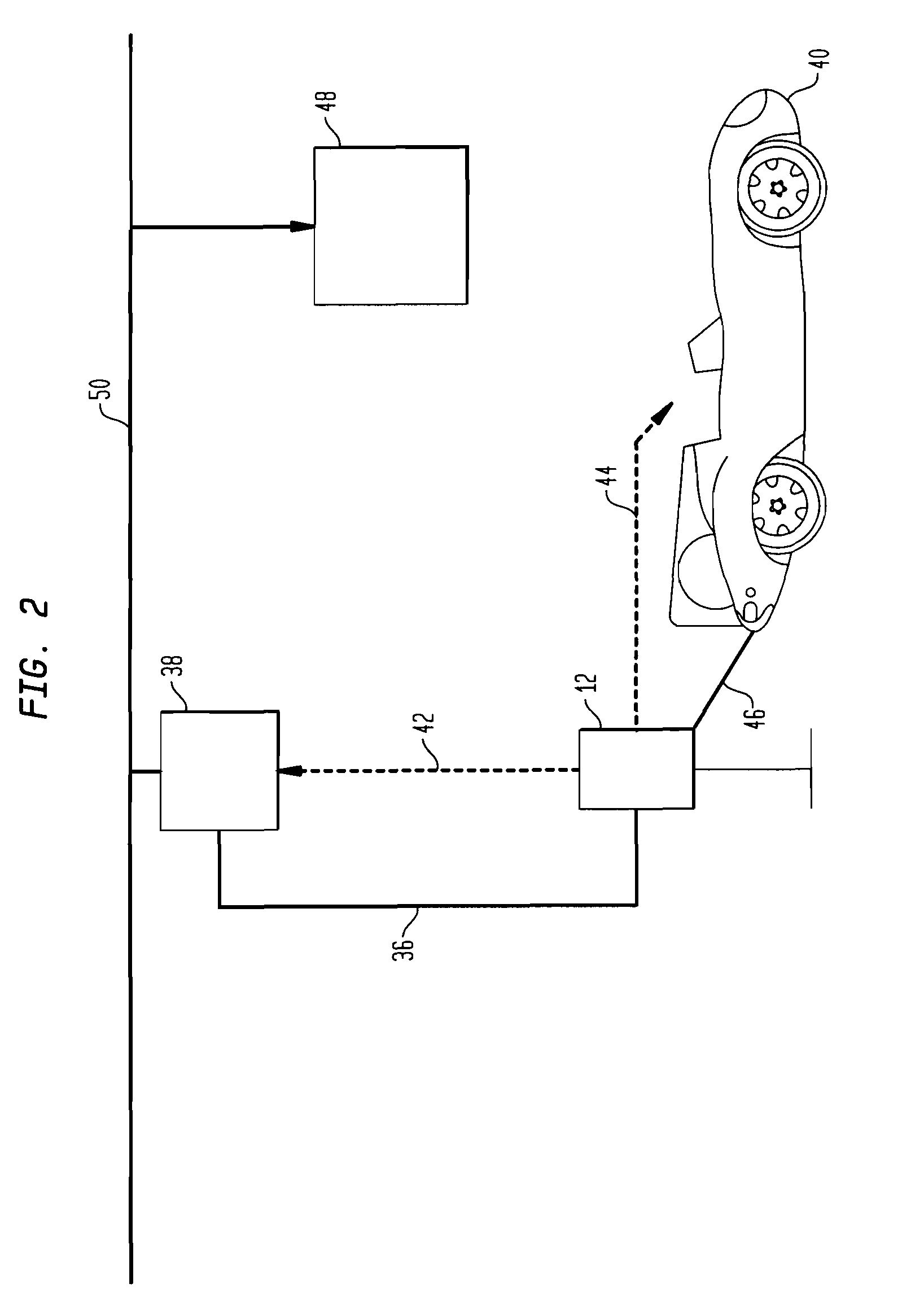

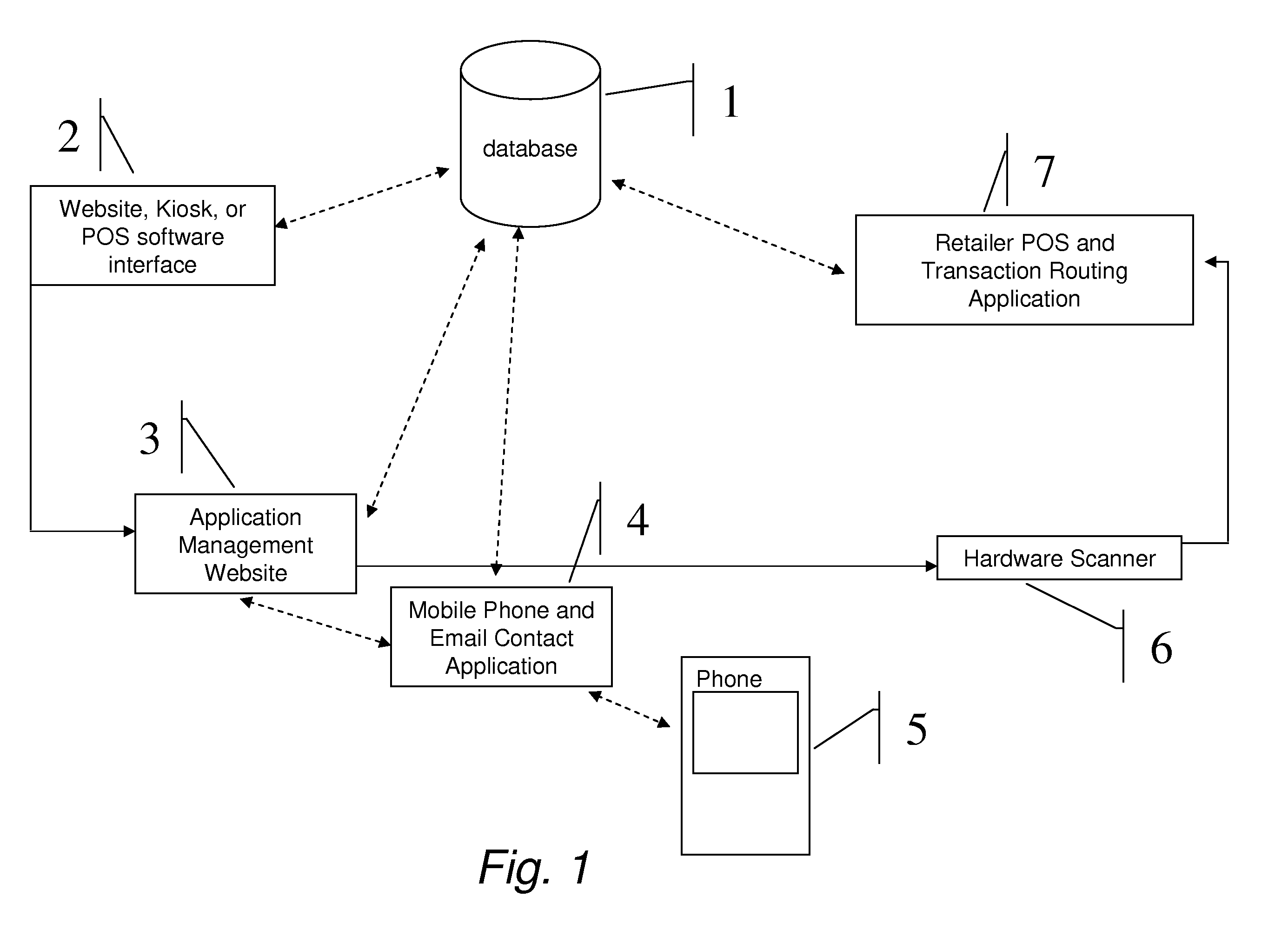

Disclosed is a method and system for use of an image-based payment medium through images stored on the consumer's mobile phone in place of traditional plastic gift, credit or debit cards. Upon authentication, an image is sent to the consumer's mobile phone. The consumer displays the image at the retailer's point of sale when completing a transaction. The image is scanned with a barcode reader, a webcam or other scanning device and the consumer's account in a database is debited or credited based on the amount and type of transaction. An image-base payment medium provides for the ability to target specific ads to the consumer, directed to the registered mobile phone number and also to attach loyalty and coupon programs to the account, which the recipient may redeem upon scanning of the encoded image on the mobile phone at the point of sale. The system and method is suitable for “virtual” gift cards, credit and debit cards, loyalty payment programs and other methods of value exchange.

Owner:MANDKE SAMEER

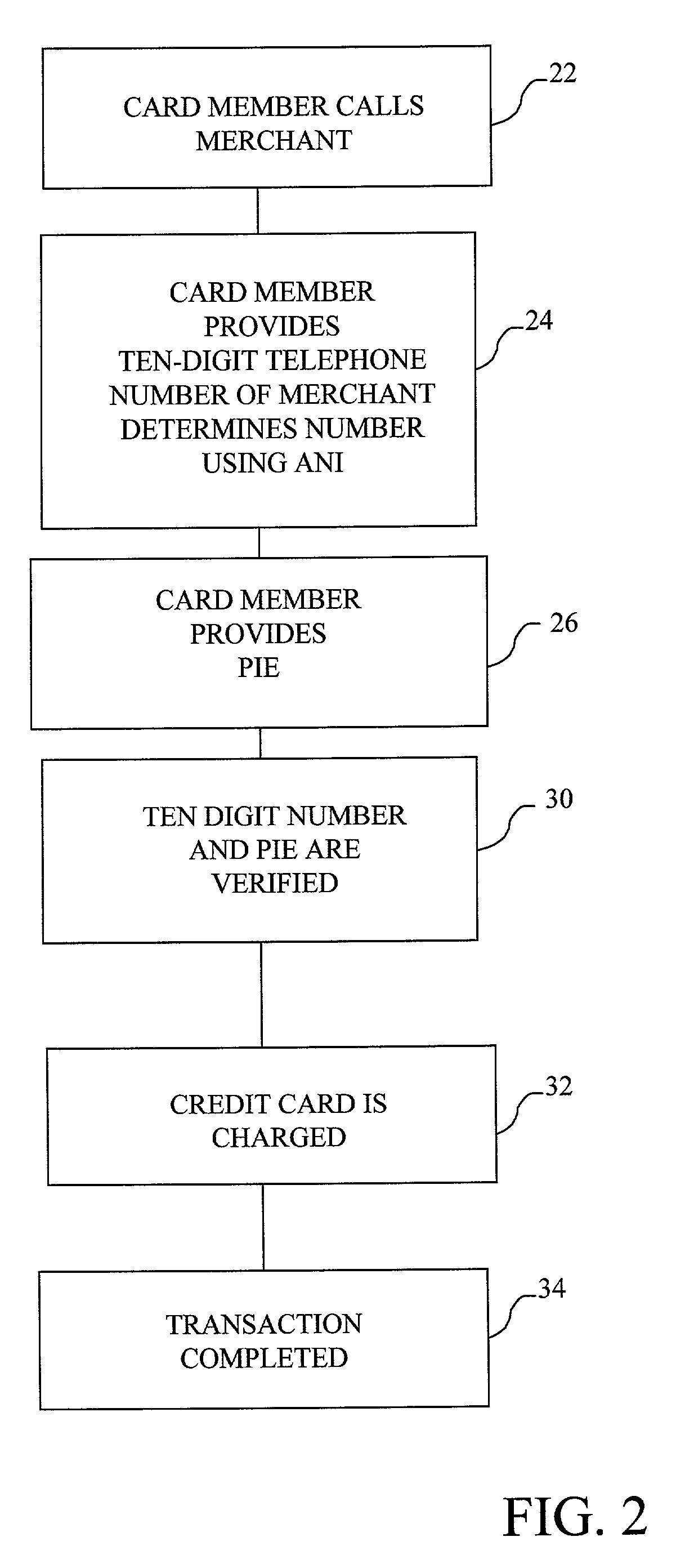

Methods for providing cardless payment

ActiveUS7099850B1Convenient and easy to rememberConvenient and/orPublic key for secure communicationPayment protocolsComputer hardwareThe Internet

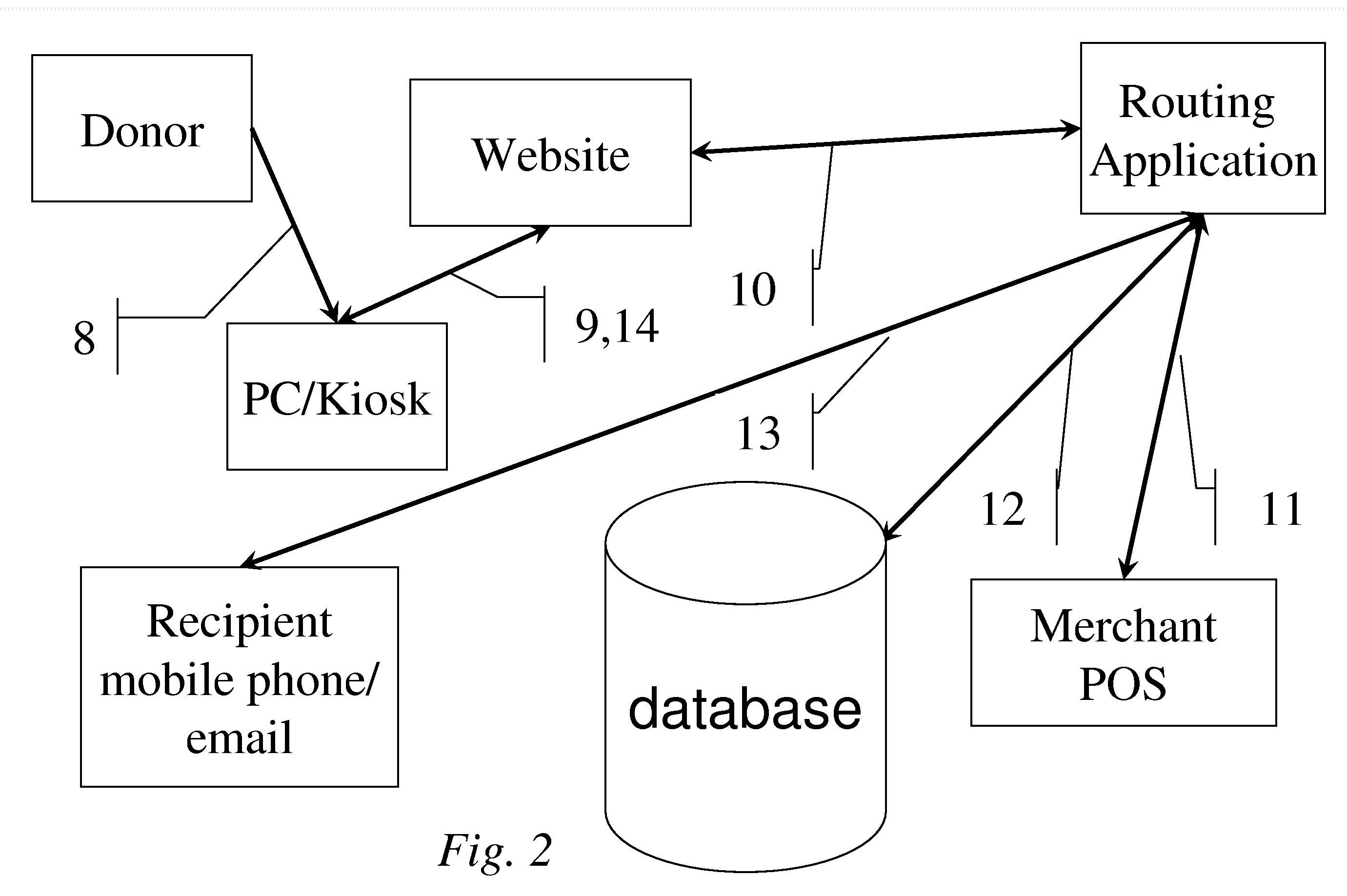

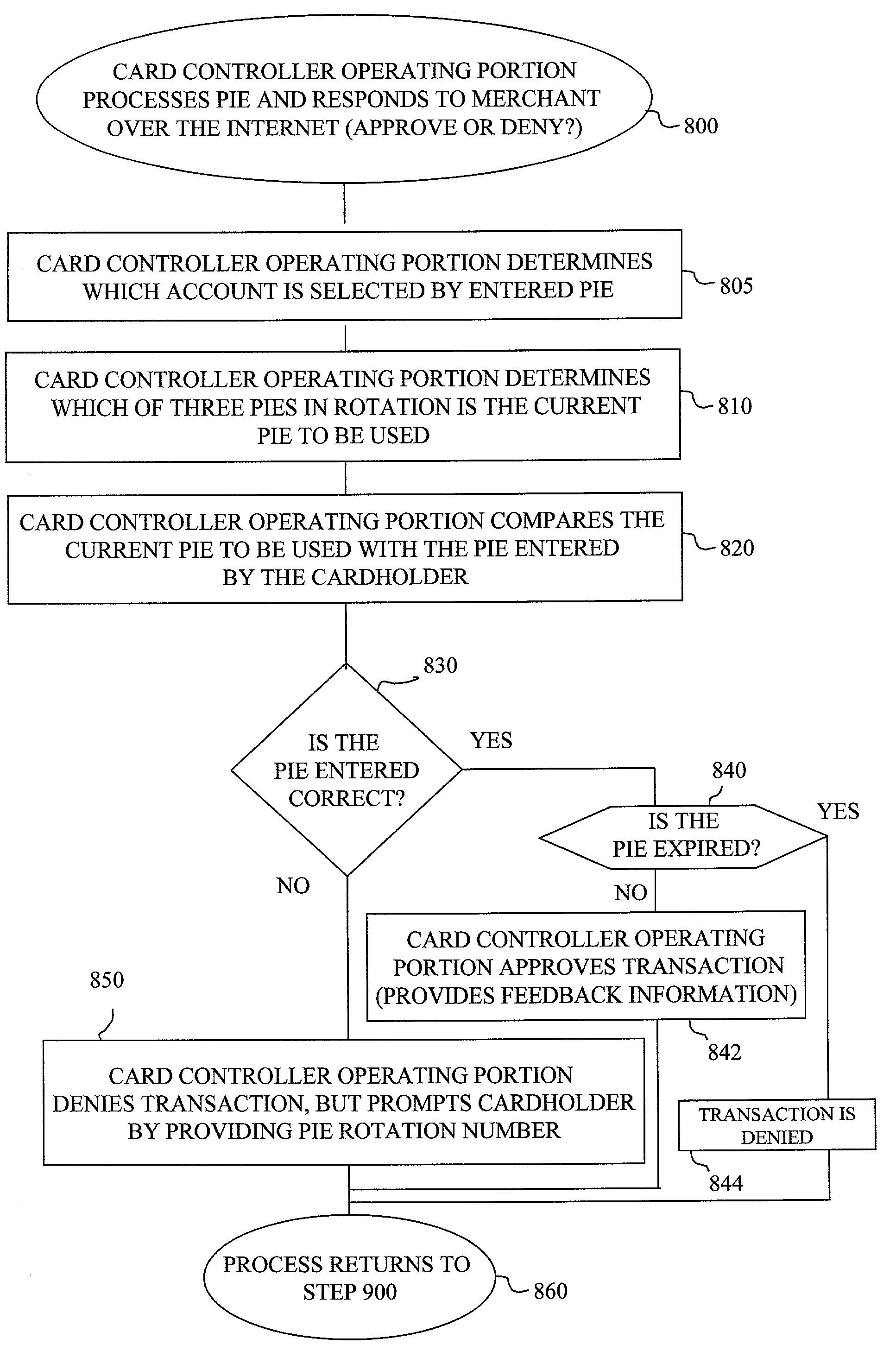

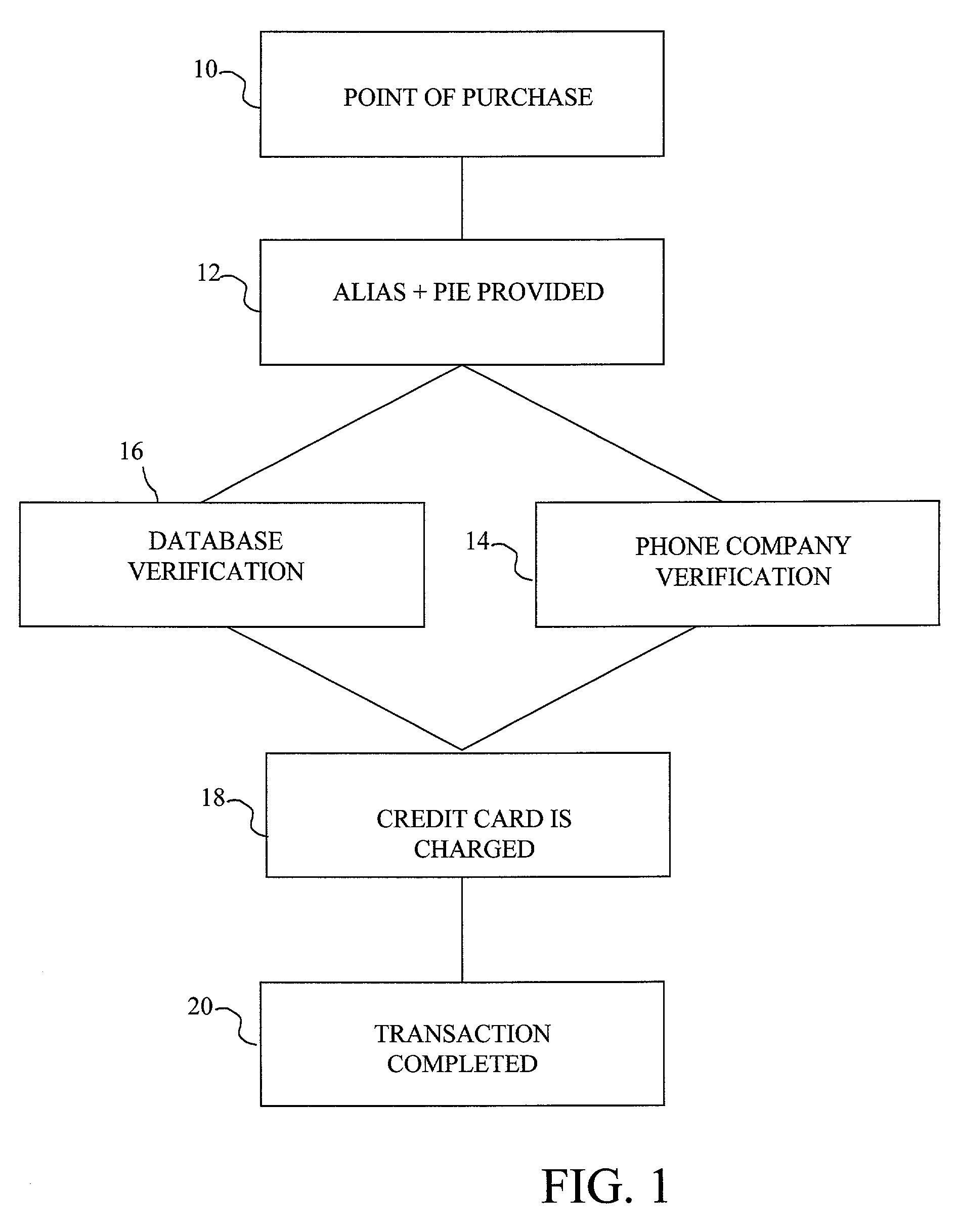

The method and system of the invention provide a variety of techniques for using a selected alias and a selected personal identification entry (PIE) in conjunction with use of a transaction card, such as a credit card, debit card or stored value card, for example. A suitable number or other identification parameter is selected by the account-holder as an alias. The account-holder is then required to choose a PIE for security purposes. The alias is linked to the account-holder's credit card number via a database. When the account-holder enters into a transaction with a merchant, the physical card need not be present. The account-holder simply provides his or her alias and then the PIE. This can be done at any point of sale such as a store, catalog telephone order, or over the Internet. The alias and PIE are entered and authorization is returned from the credit card company.

Owner:JPMORGAN CHASE BANK NA

Cashless payment system

InactiveUS20050015332A1Without any loss of transaction processing flexibilityWidespread acceptanceFinanceBuying/selling/leasing transactionsComputer networkEngineering

A payment system that does not rely on credit or debit cards, does not require the merchant and purchaser to have compatible memberships to complete a transaction, and does not limit single transactions to a single account provides a wide range of flexibility permitting debit, credit, pre-paid and payroll cards to be accommodated in a seamless and invisible manner to the electronic transaction network. The transaction may be verified and approved at the point-of-sale whether or not the merchant is a member of a specific financial transaction system. Specifically, the point-of-sale transaction system permits an identified customer to use any of a variety of payment options to complete the transaction without requiring the merchant to pre-approve the type of payment selected by the customer. In one configuration, and in order to take advantage of the widespread use of the ATM / POS network, the invention uses a typical credit / debit card format to provide the identifying information in a stored value card. When a transaction is to be completed, the user enters the identifying information carried on the card at the point-of-sale. This can be a merchant or other service provider at a retail establishment, or on-line while the user is logged onto a web site, or other location. The information can be swiped by a card reader, or manually entered via a keyboard or other input device. The system supports a wide range of flexibility, permitting issuing systems such as parents and state welfare agencies to restrict the types of authorized uses, and permitting users to access accounts in a prioritized manner. Further, the accepting merchant is not required to be a member because settlement with the merchant may be made via the Federal Reserve Automatic Clearing House (ACH) system by typical and standard electronic transfer. This permits the merchant to take advantage of the lower ACH transaction fees with even greater convenience and flexibility than the current ATM / POS system. The system supports numerous types of identification methods from typical credit card structures with magnetic data strips to various biometric systems such as finger prints, facial recognition and the like. Specifically, once the user is identified, the transaction is managed by his membership data on record with the transaction processing system.

Owner:ECOMMLINK

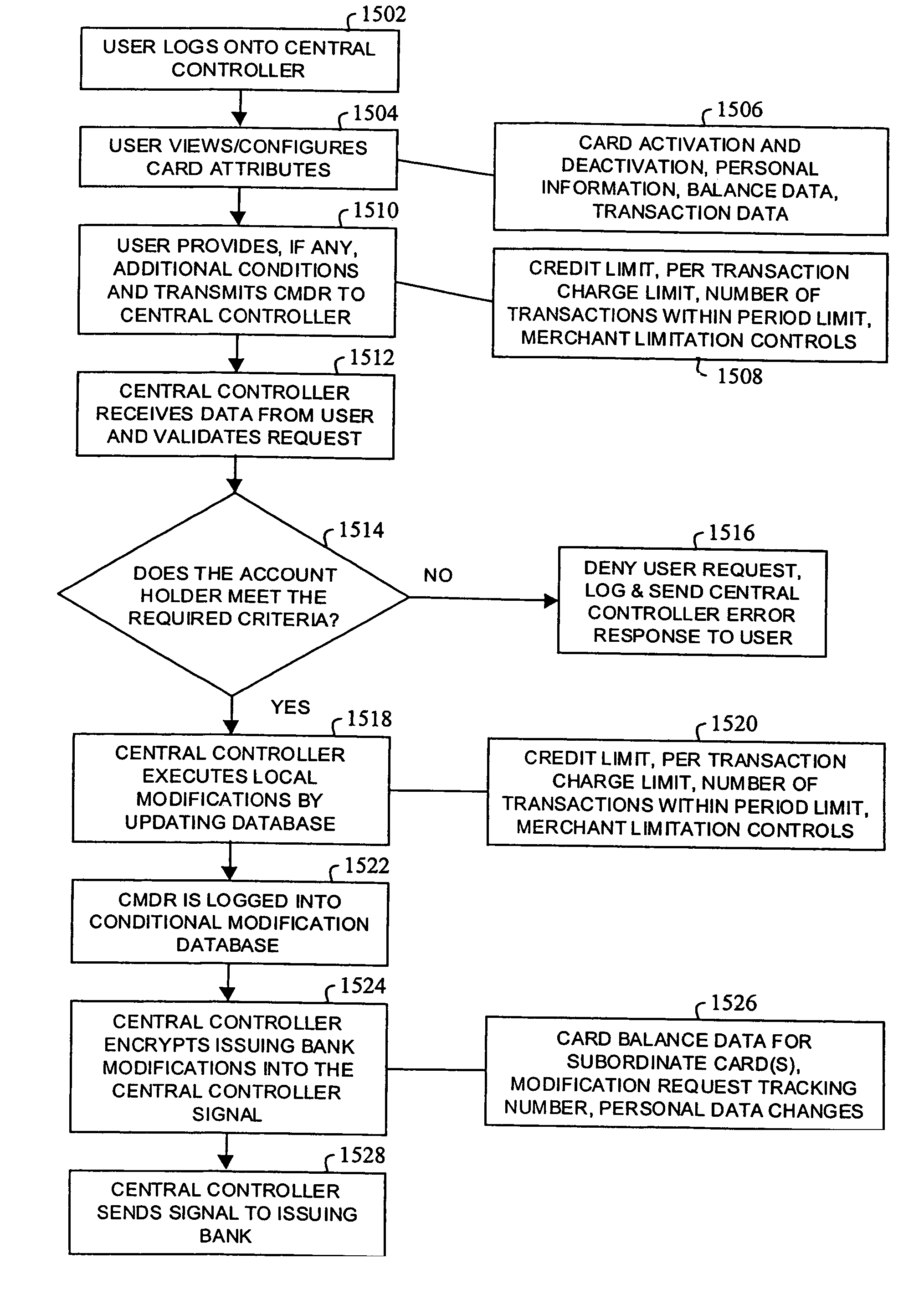

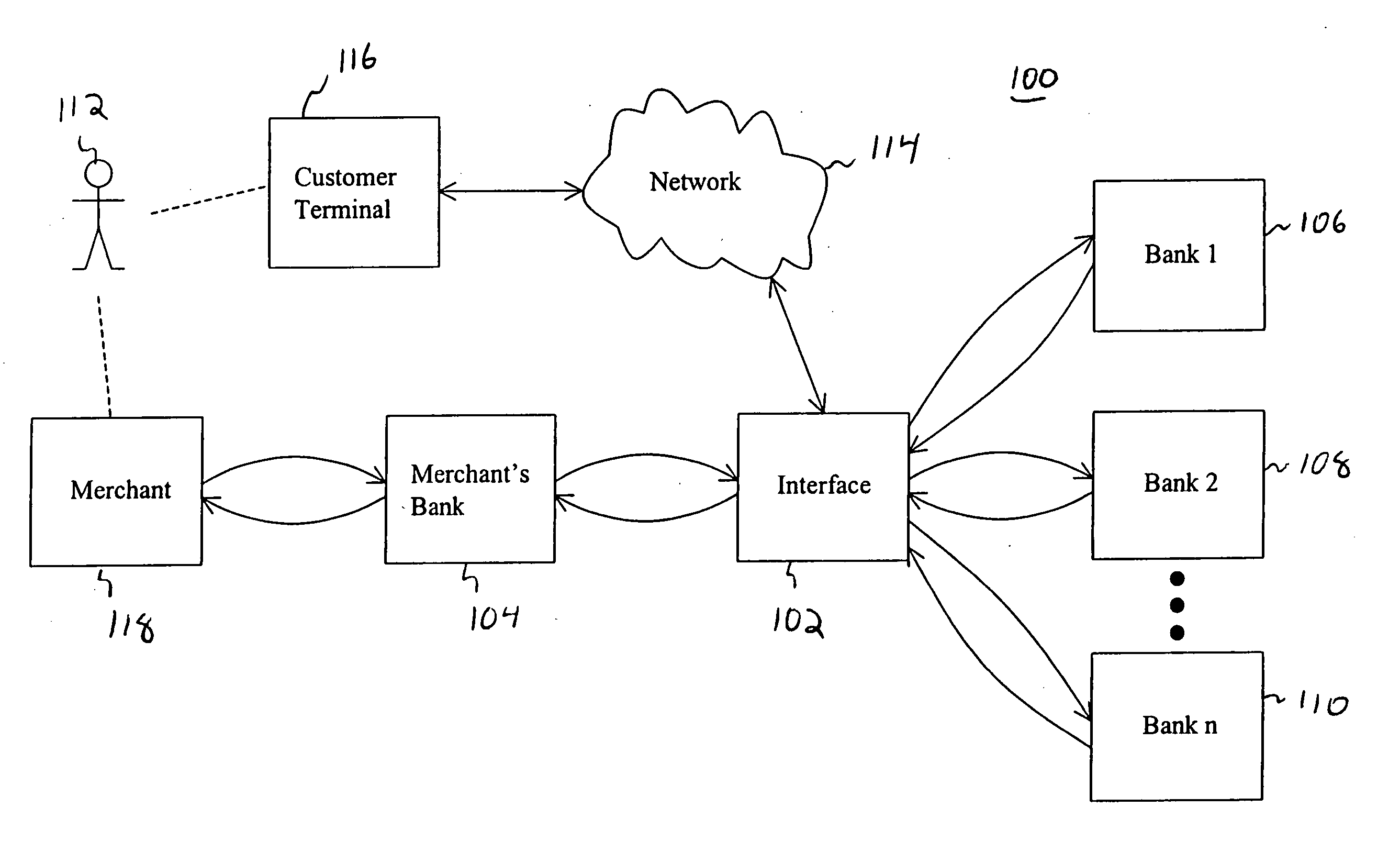

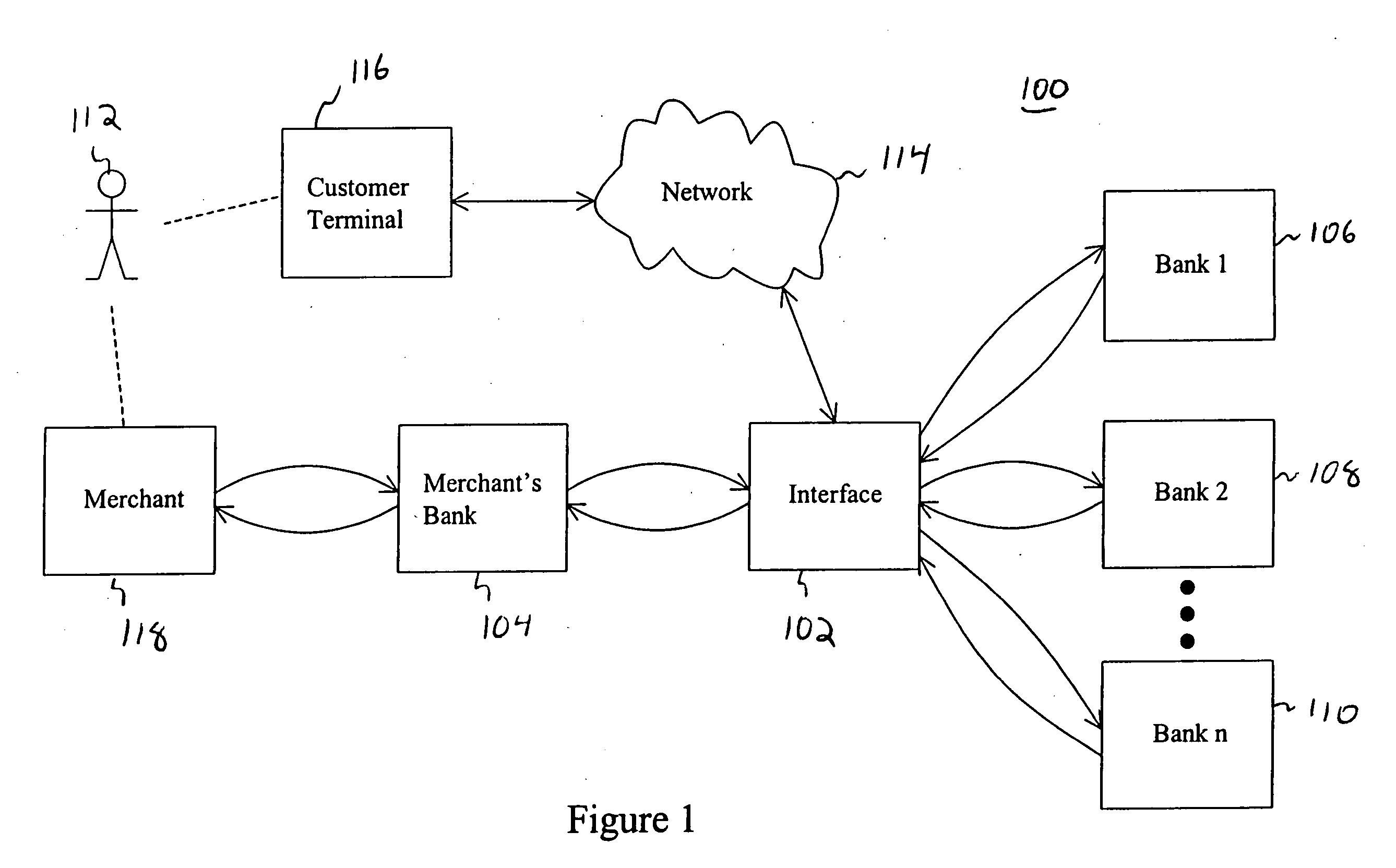

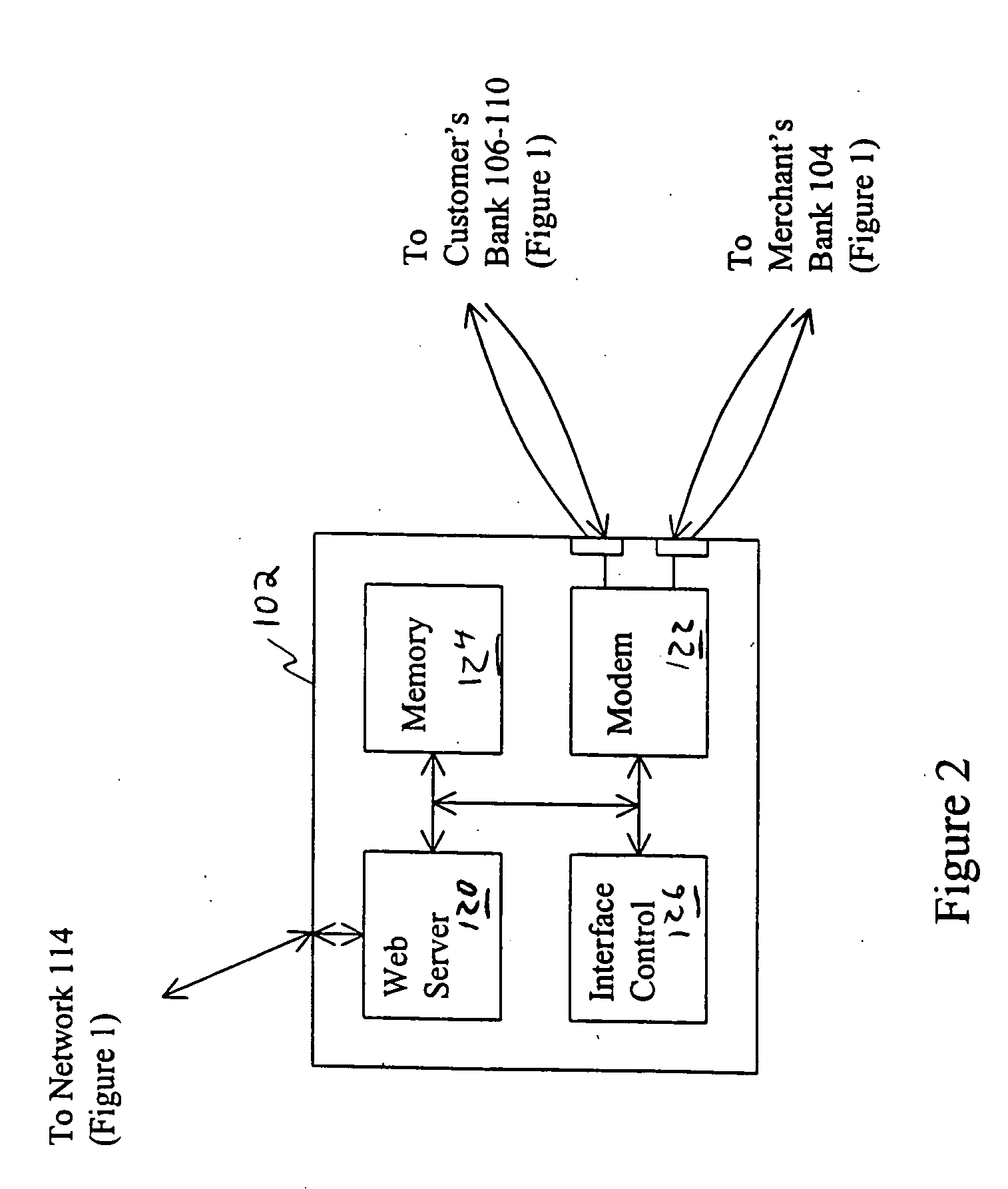

System and method for consumer control over card-based transactions

A system and method for consumer control over card-based transactions and associated accounts. An interface is provided between a merchant or the merchant's bank and the bank or banks at which the consumer has accounts for card-based transactions. The interface acts as an intermediary which is accessible to the consumer so that the consumer may place a variety of controls on card-based transactions. For example, multiple transaction cards may be linked to a single credit account with each card having a different credit limit. As another example, each transaction card may be restricted to a particular merchant. As yet another example, a consumer may link several credit and / or debit accounts to a single transaction card; the consumer may pre-select criteria to be utilized for directing charges for a particular transaction to be applied the different accounts. The consumer may access the interface via a web site or a telephone for making changes and receiving account information. Flexibility and control over the use of transaction cards is, therefore, provided for card-based transactions and for debit and credit accounts used in connection with such card-based transactions.

Owner:MASTERCARD INT INC

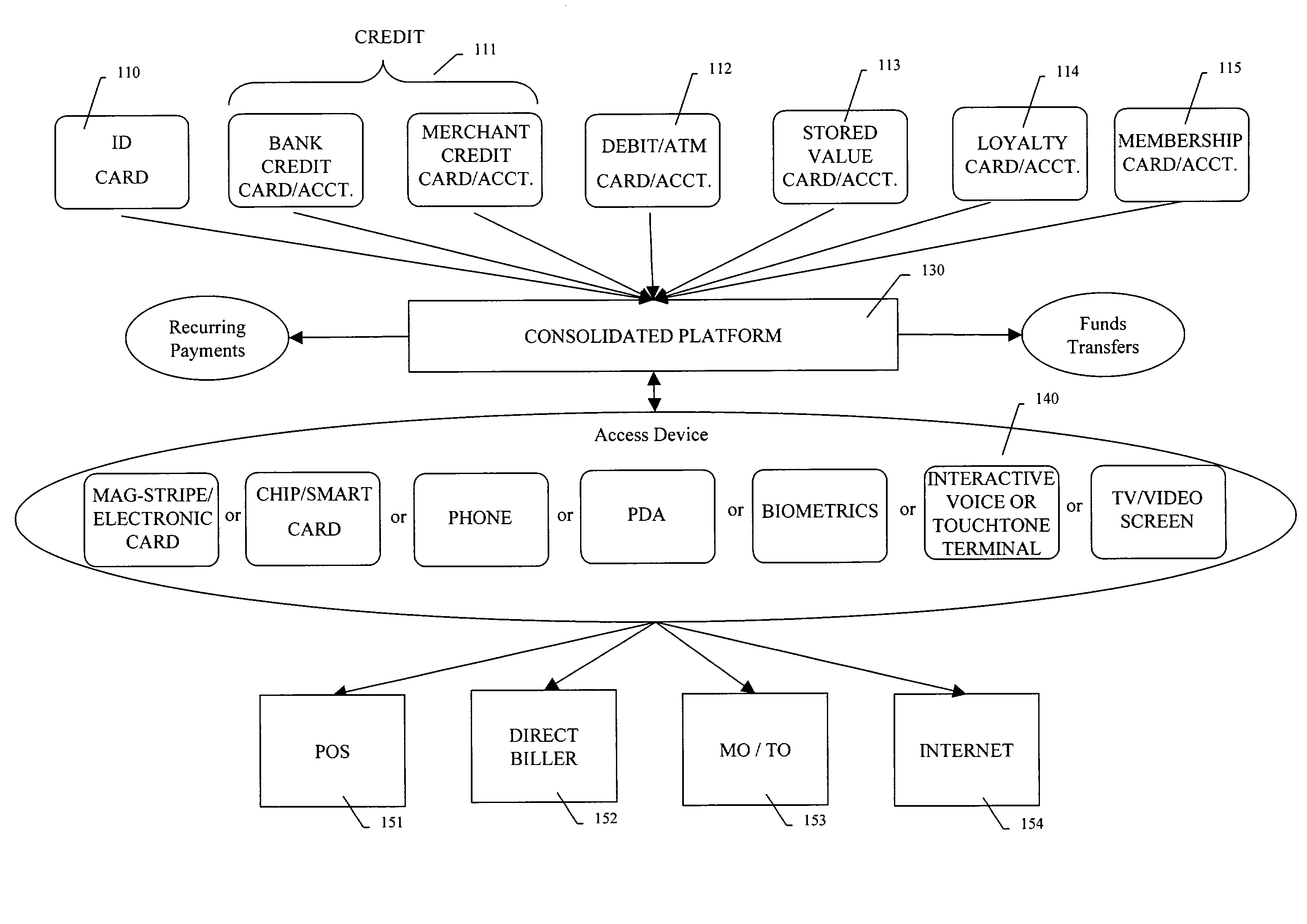

Method and system for a multi-purpose transactional platform

ActiveUS8412623B2Easy to manageEliminate needFinancePayment protocolsComputer networkComputer science

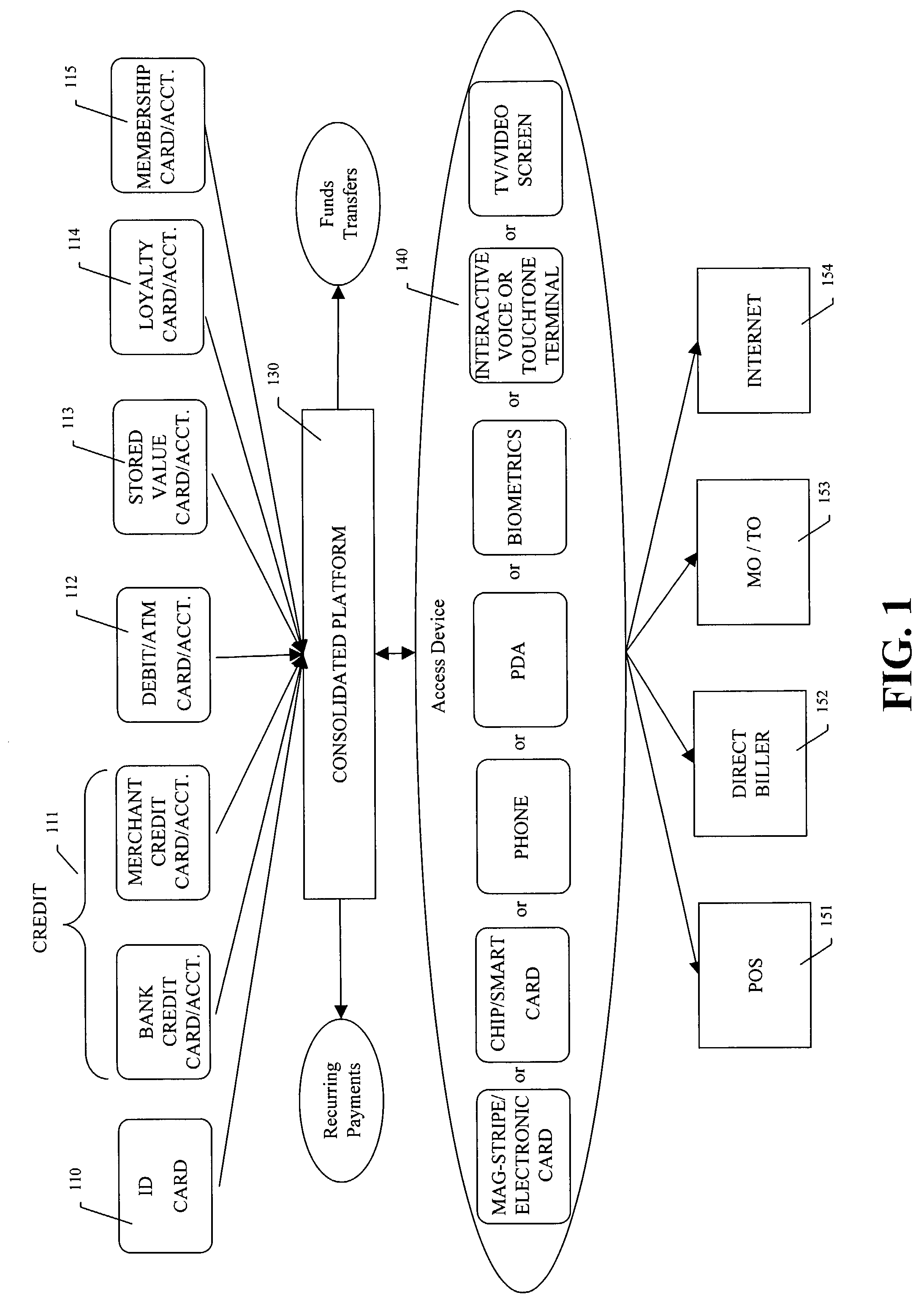

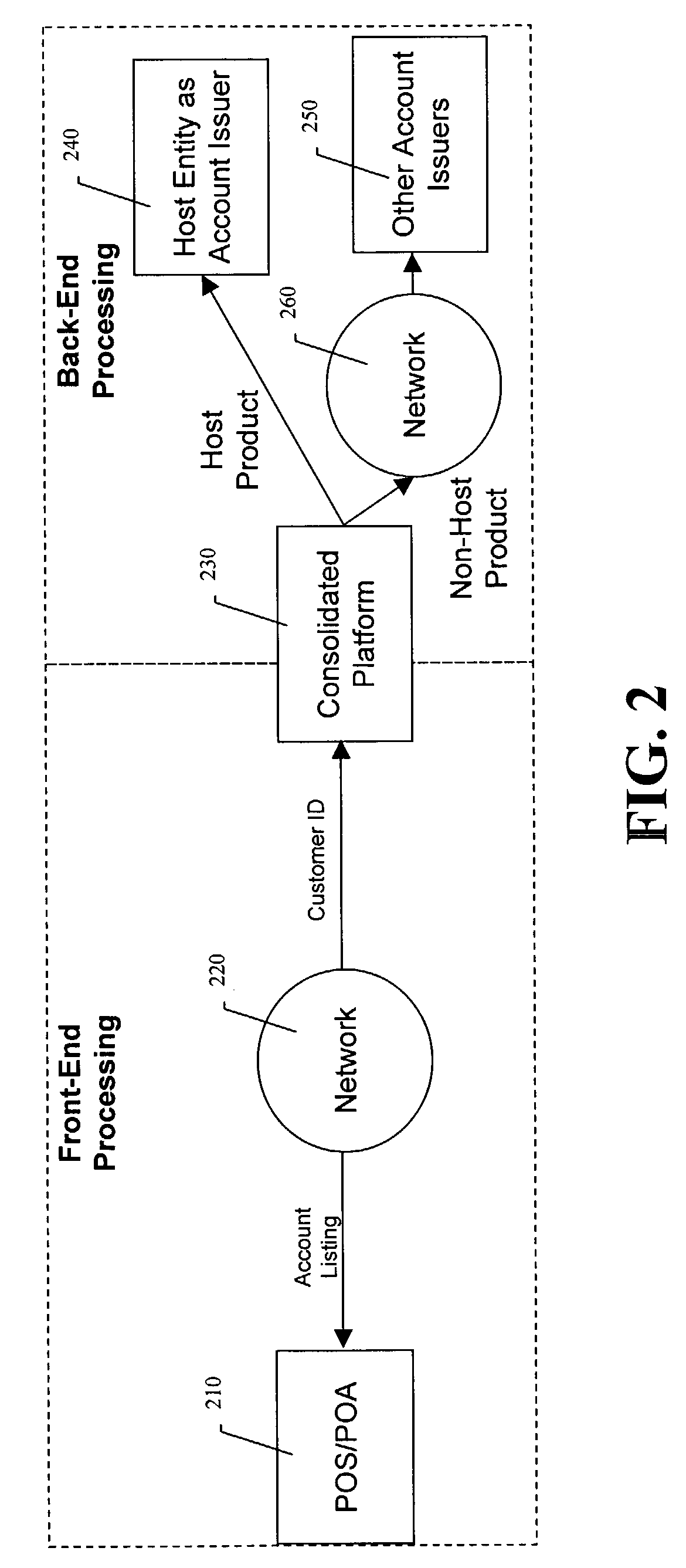

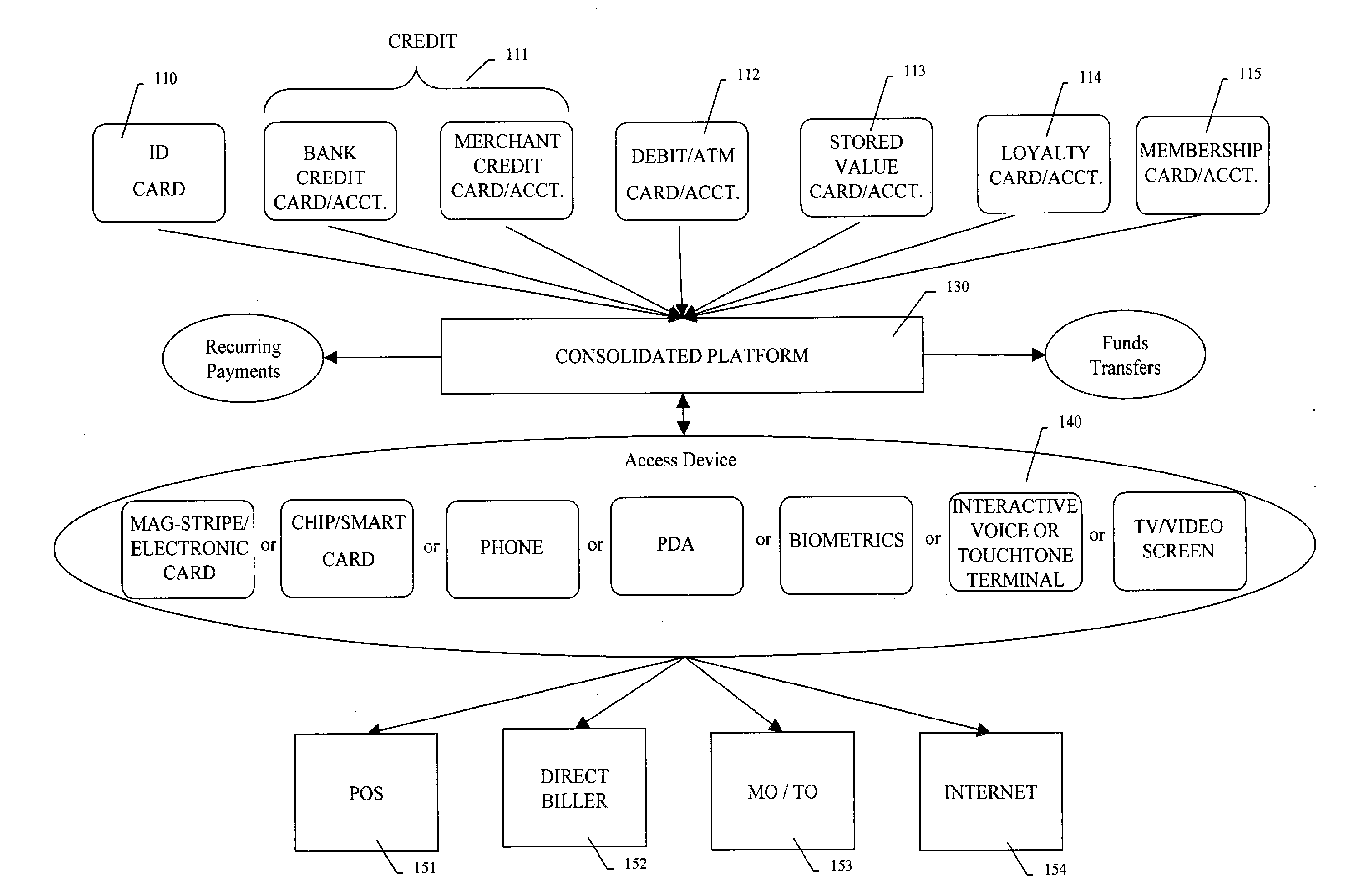

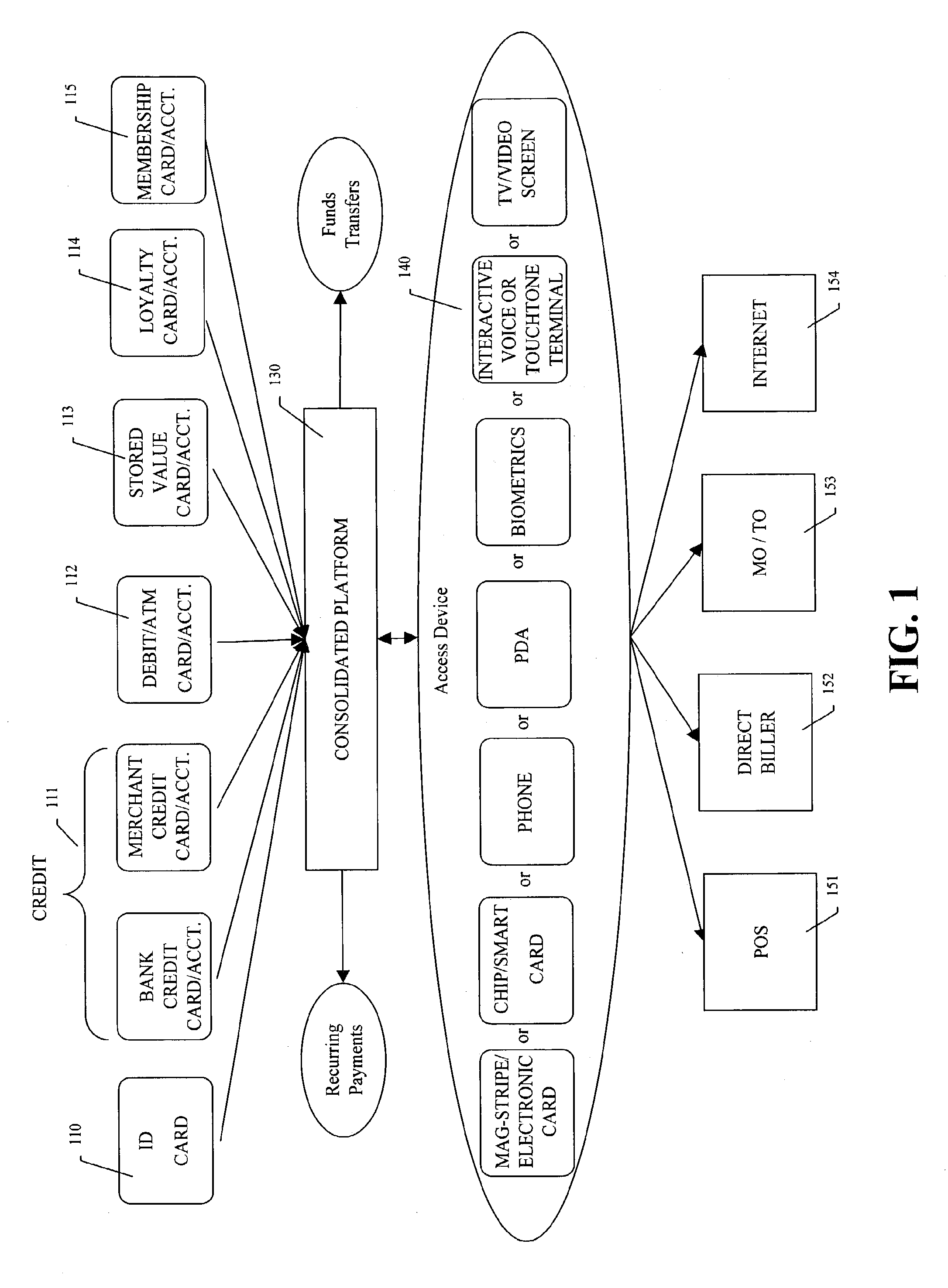

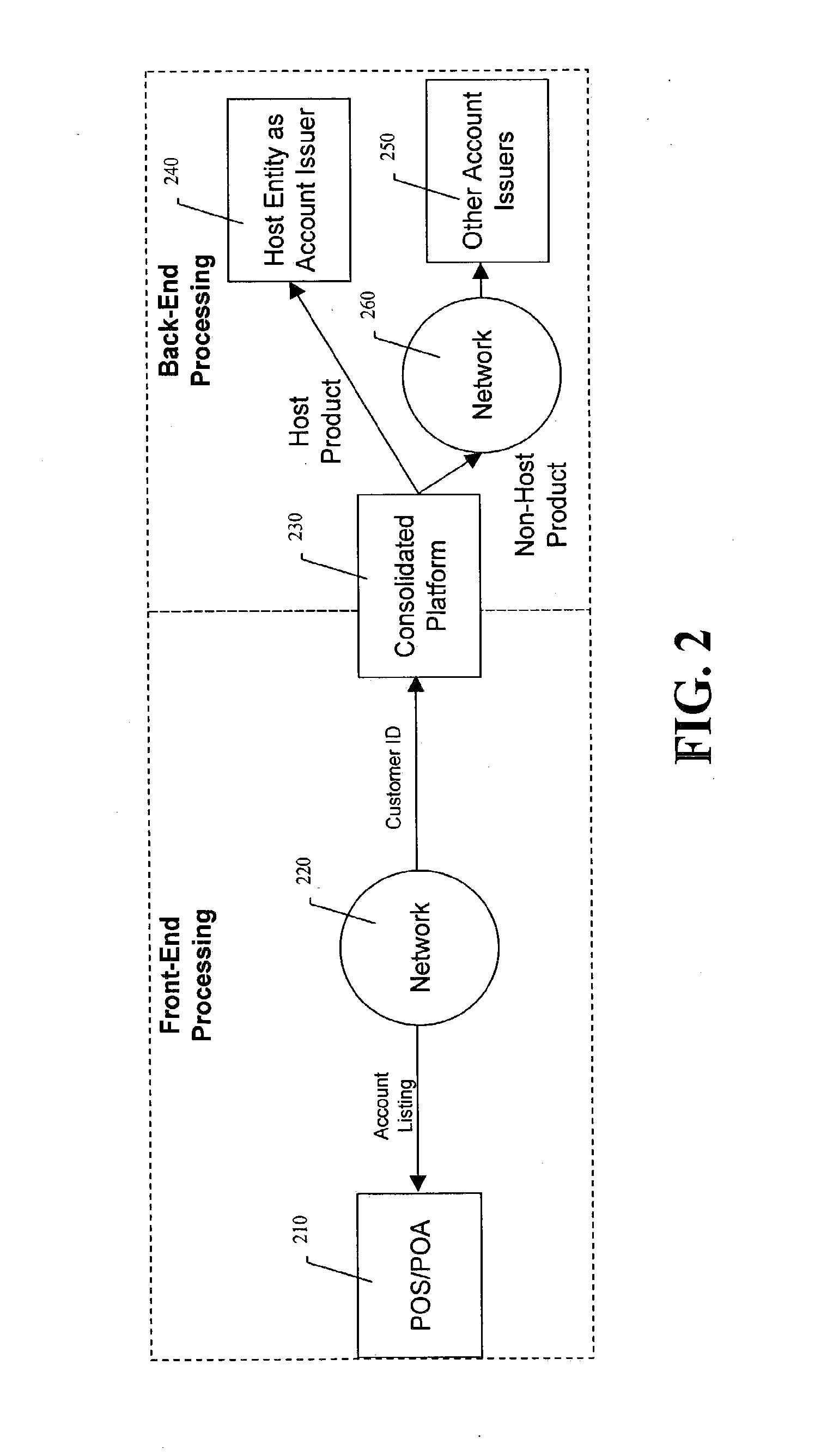

The present invention relates particularly to a method and system for consolidating a plurality of a consumer's payment and non-payment source accounts into a consolidated platform with a customer identification or available proxy account numbers that can be assigned to source accounts. The source accounts can be, for example, credit card accounts, ATM accounts, debit card accounts, demand deposit accounts, stored-value accounts, merchant-loyalty card accounts, membership accounts, and identification card numbers. The consumer can access and modify any of the source accounts and manage funds across the source accounts by accessing the consolidated platform with a single access device or mode.

Owner:CITICORP CREDIT SERVICES INC (USA)

Method and System for a Multi-Purpose Transactional Platform

InactiveUS20130218698A1Easy to manageEliminate needHand manipulated computer devicesFinanceComputer networkCustomer identification

The present invention relates particularly to a method and system for consolidating a plurality of a consumer's payment and non-payment source accounts into a consolidated platform with a customer identification or available proxy account numbers that can be assigned to source accounts. The source accounts can be, for example, credit card accounts, ATM accounts, debit card accounts, demand deposit accounts, stored-value accounts, merchant-loyalty card accounts, membership accounts, and identification card numbers. The consumer can access and modify any of the source accounts and manage funds across the source accounts by accessing the consolidated platform with a single access device or mode.

Owner:CITICORP CREDIT SERVICES INC (USA)

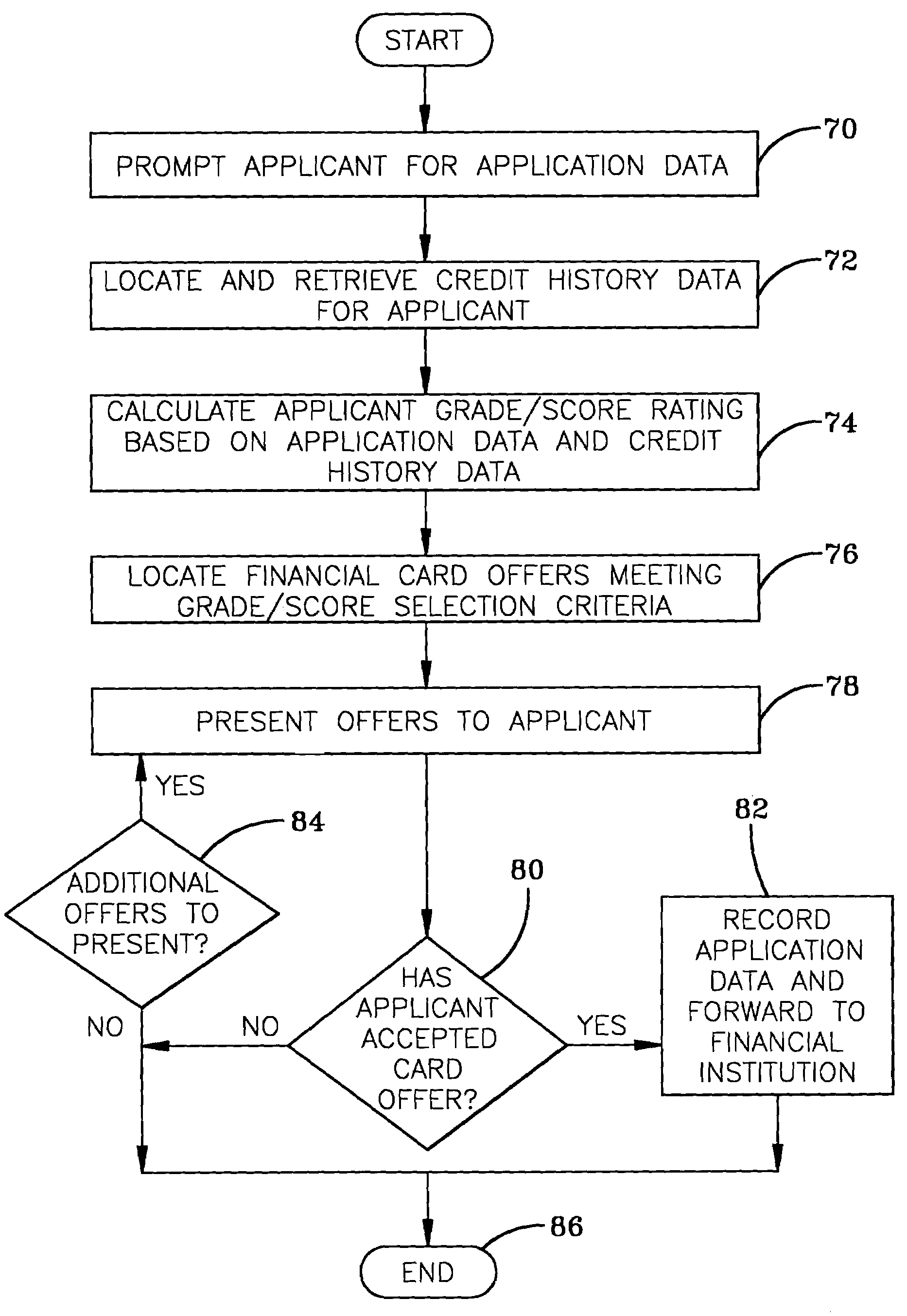

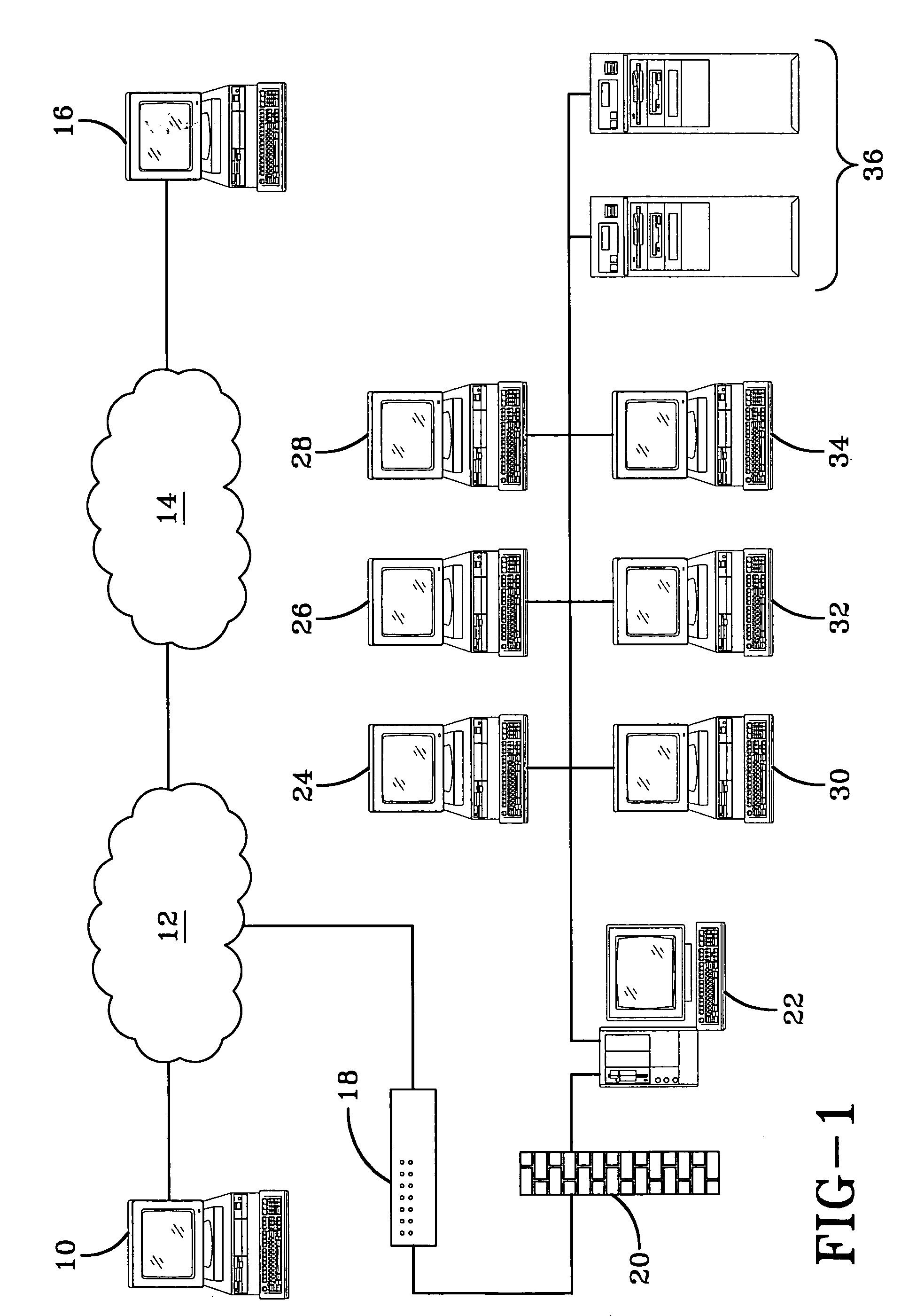

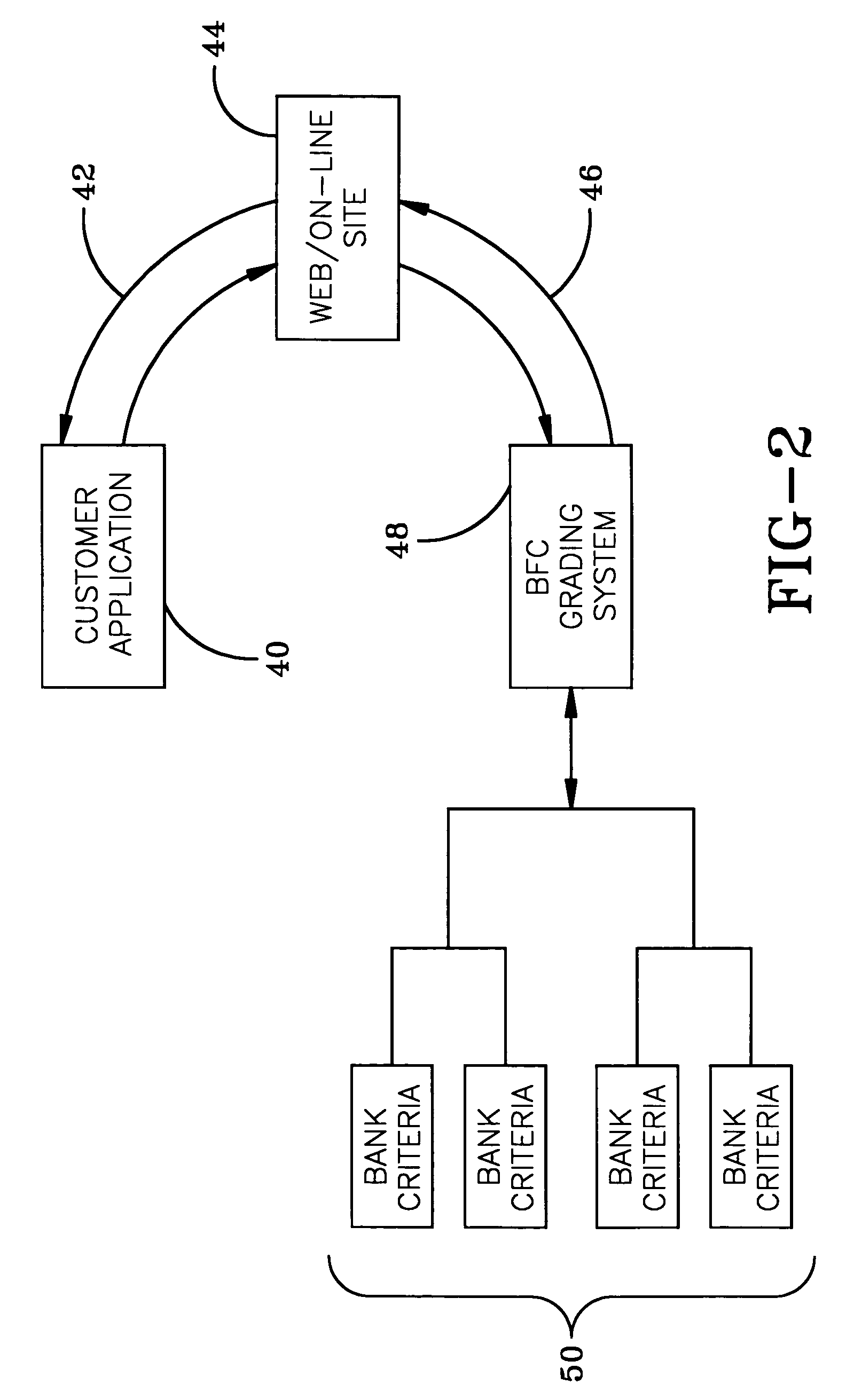

Real-time financial card offer and application system

A system is disclosed for presenting financial card (e.g., credit card, debit card) offers to potential customers. Financial card applicant selection criteria and financial card term data are provided by participating financial institutions. An applicant interested in applying for a new financial card accesses the system via the Internet / World Wide Web. The applicant provides personal and financial data that are then analyzed in conjunction with data from outside sources (such as credit bureaus) to determine a financial risk rating for the applicant. The rating is used to locate financial card offers appropriate for the applicant. The applicant then peruses the offers and chooses one that meets his or her personal selection criteria. The applicant's data is then forwarded for processing to the participating financial institution that made the selected offer.

Owner:BLOCK FINANCIAL

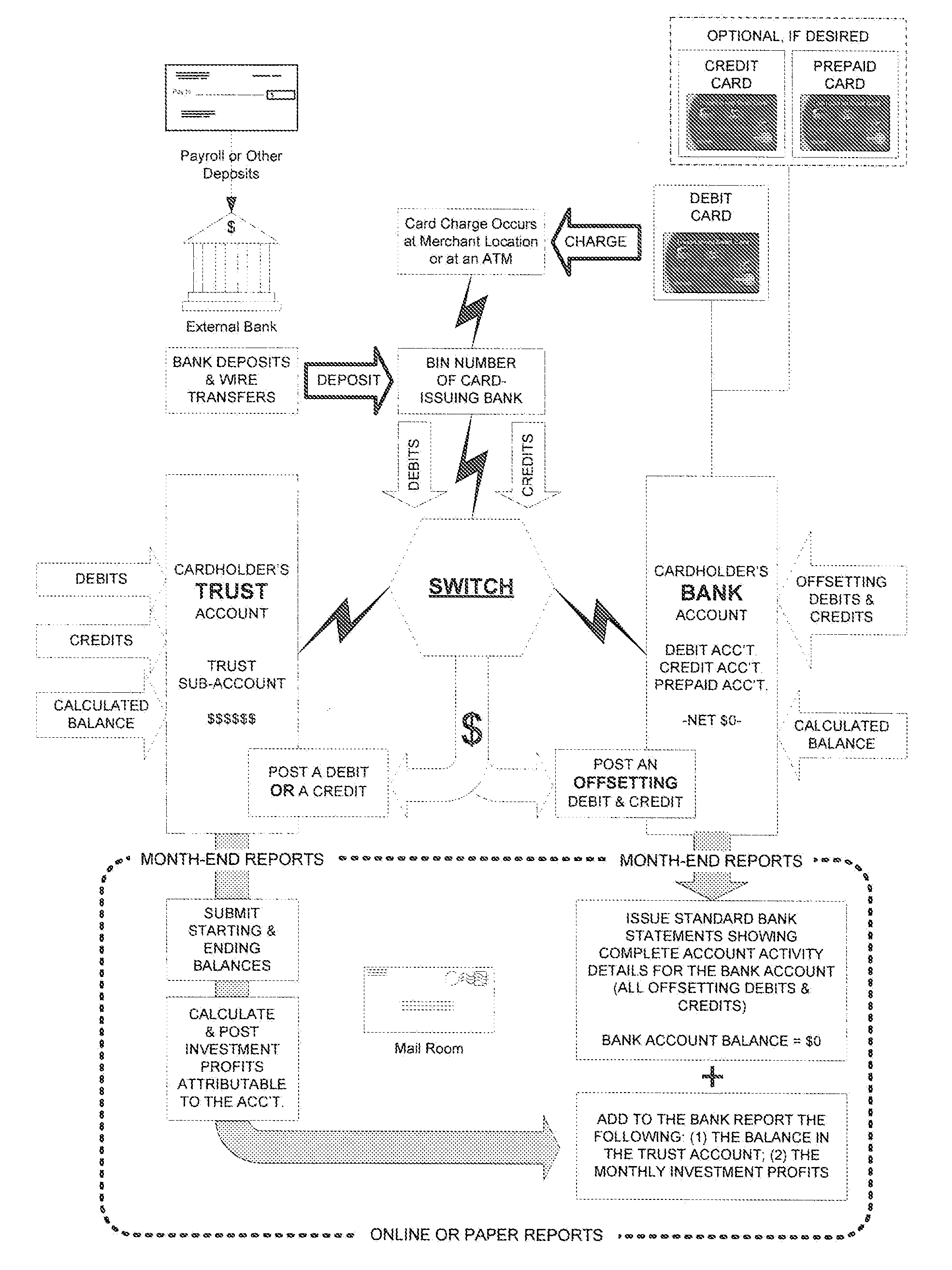

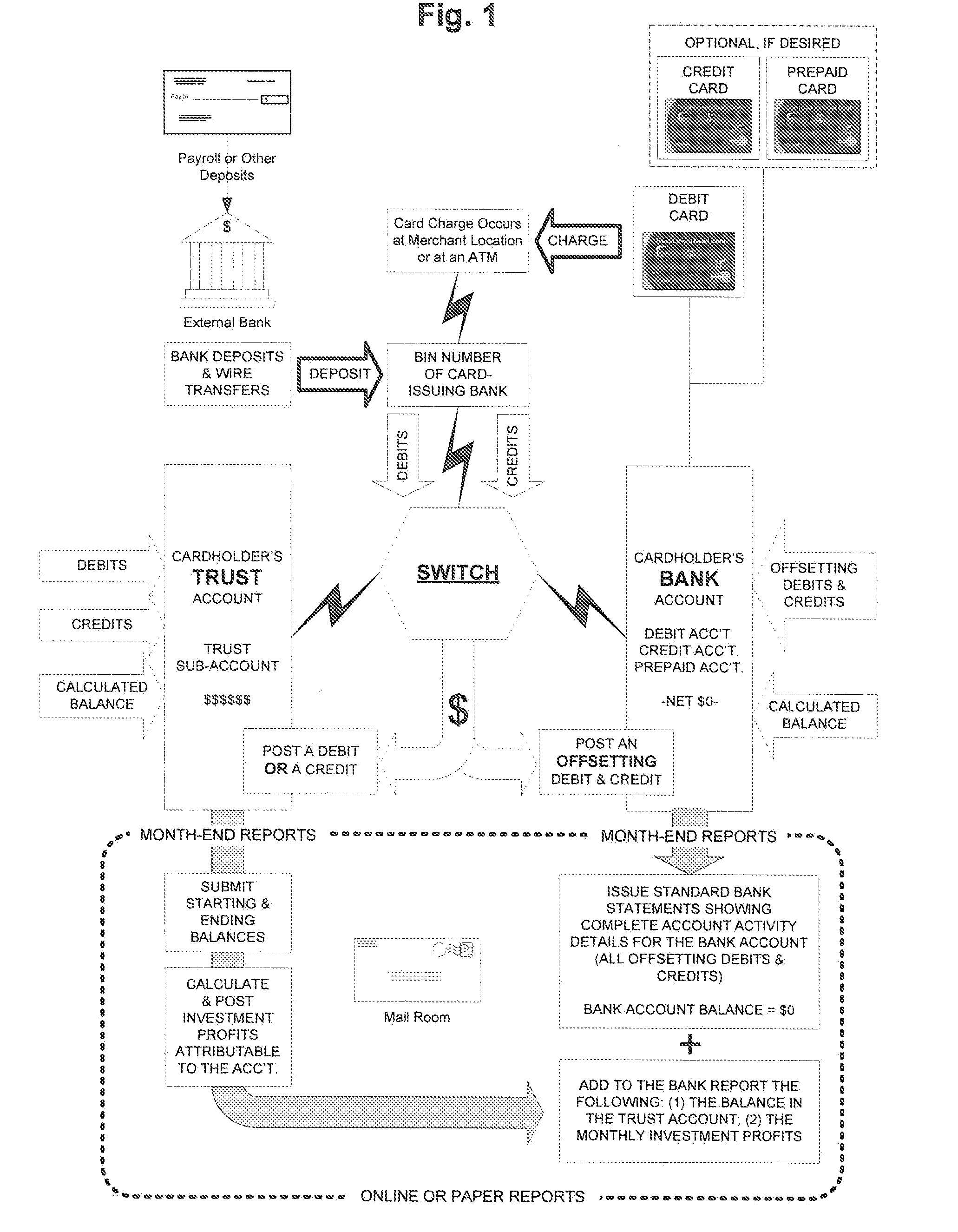

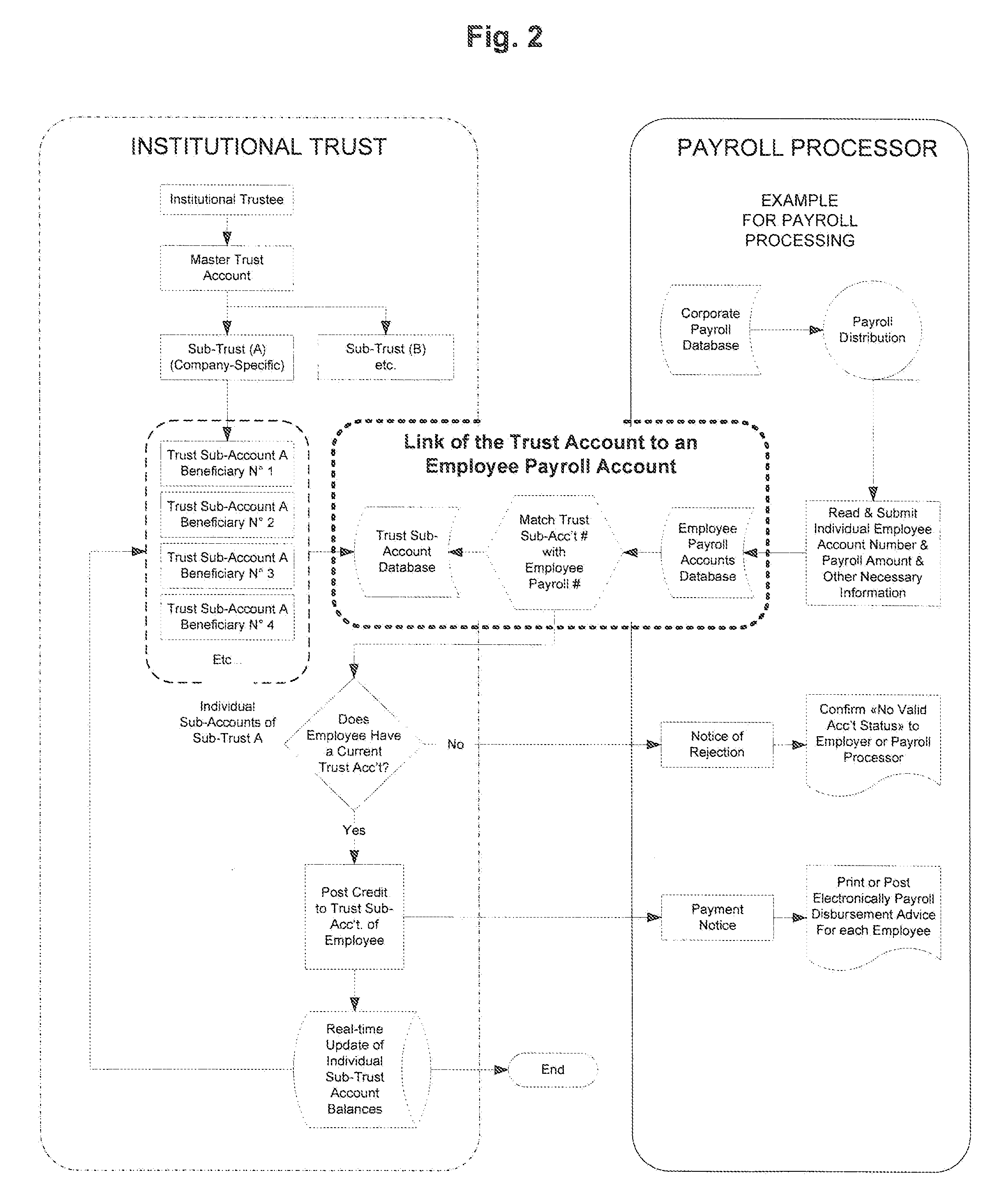

Revenue-producing bank card system & method providing the functionality & protection of trust-connected banking

A revenue-producing, charge card system also manages account balances to create an investment profit for the card holder. A trust account has a trust-account balance reflecting a first amount of funds, is constructed to subsequently record debits and credits related to the balance, and is constructed for access via remote communication. A bank account has a bank-account balance reflecting an initial zero balance, is constructed to further record debits and credits related to the balance, and is constructed for access via remote communication. A debit card is constructed for communication with the trust account and the bank account, and a switch is in communication with the trust account and bank account. The trust account and the bank account are constructed for intercommunication via the switch so that a card user can pass debits and credits to the trust account through the bank account so that the funds of the trust account can be managed via the trust account. There are also methods of producing revenue thorough a charge card, a revenue-producing machine for users who have bank accounts, and a revenue-producing, debit-card system for a user who has a bank account that is connected to a trust-like structure combined with a debit card connected to the trust-like structure. In addition, there is a controller, for a networked trust account and a networked bank account that are capable of communicating via a network, that maximizes revenue to the holder of both accounts, and a corresponding method. In addition, there is a principal-protected, revenue-producing investment system, an international financial system, and a method of providing an alternative international fiduciary financial system.

Owner:DE LA MOTTE ALAN L

Persistent Dynamic Payment Service

The invention comprises online methods, systems, and software for improving the processing of payments from financial accounts, particularly credit and debit card payments made from consumers to merchants in online transactions. The preferred embodiment of the invention involves inserting a trusted third party online service into the payment authorization process. The trusted third party authenticates the consumer and authorizes the proposed payment in a single integrated process conducted without the involvement of the merchant. The authentication of the consumer is accomplished over a persistent communication channel established with the consumer before a purchase is made. The authentication is done by verifying that the persistent channel is open when authorization is requested. Use of the third party services allows the consumer to avoid revealing his identity and credit card number to the merchant over a public network such as the Internet, while maintaining control of the transaction during the authorization process.

Owner:FISHER DOUGLAS C +1

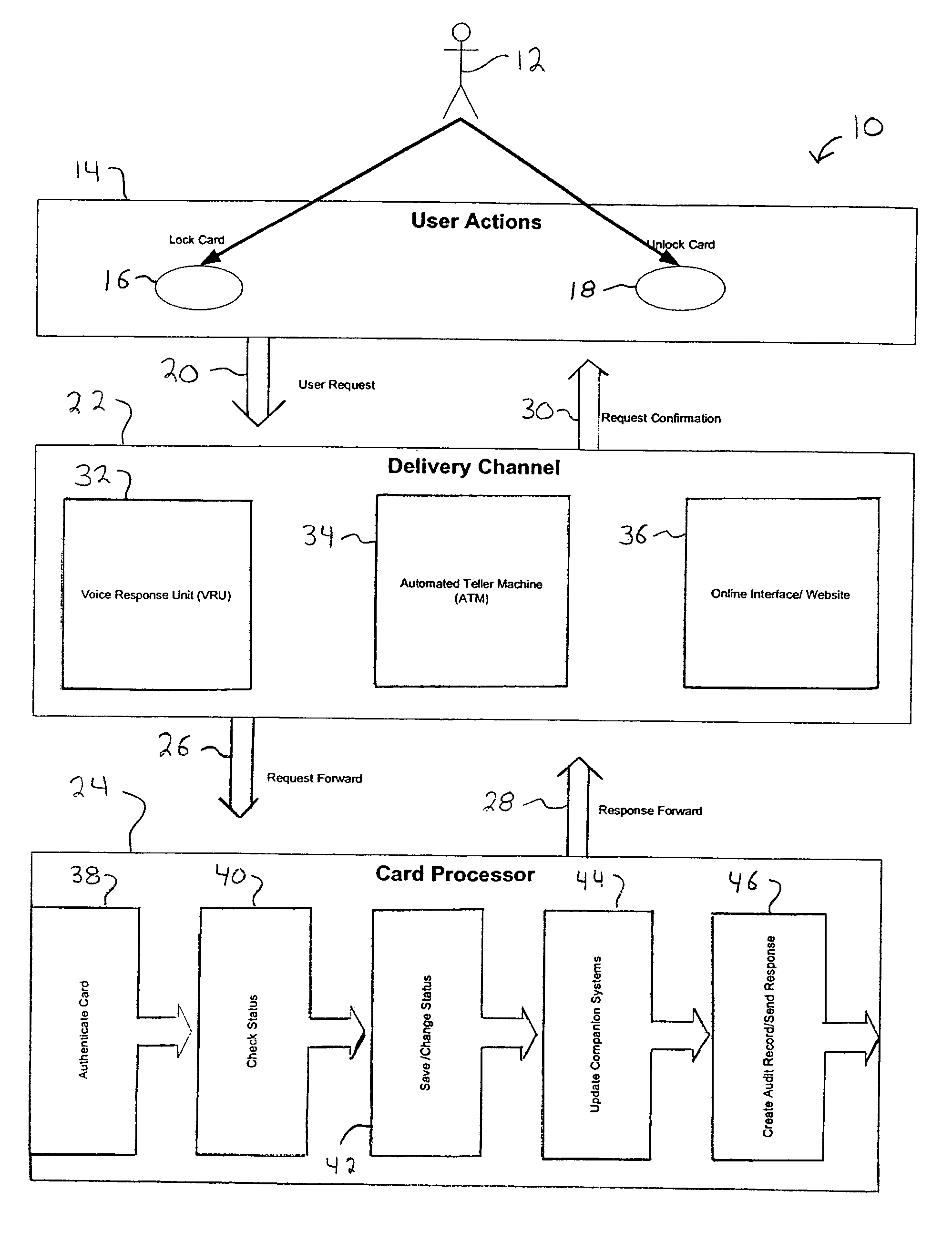

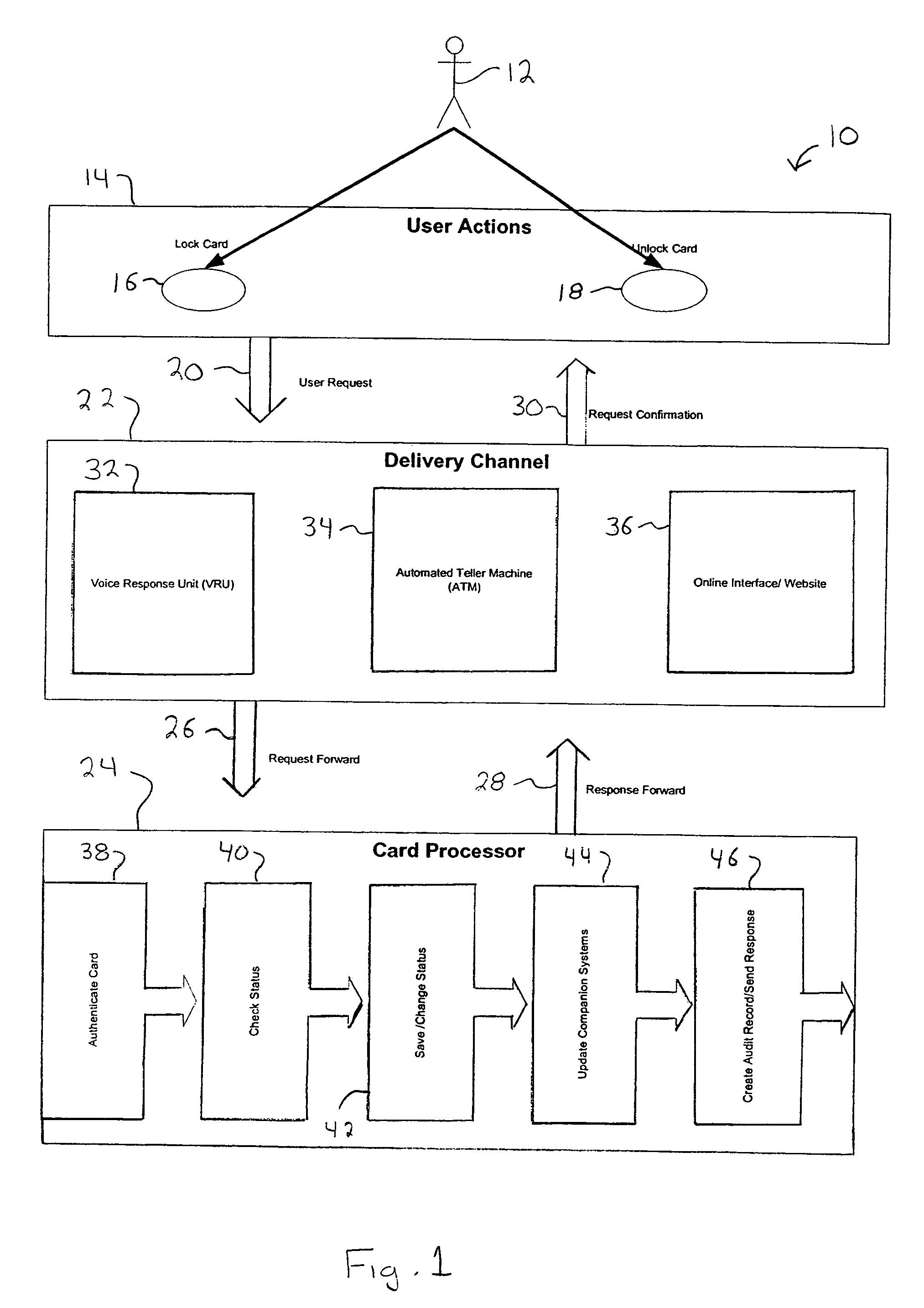

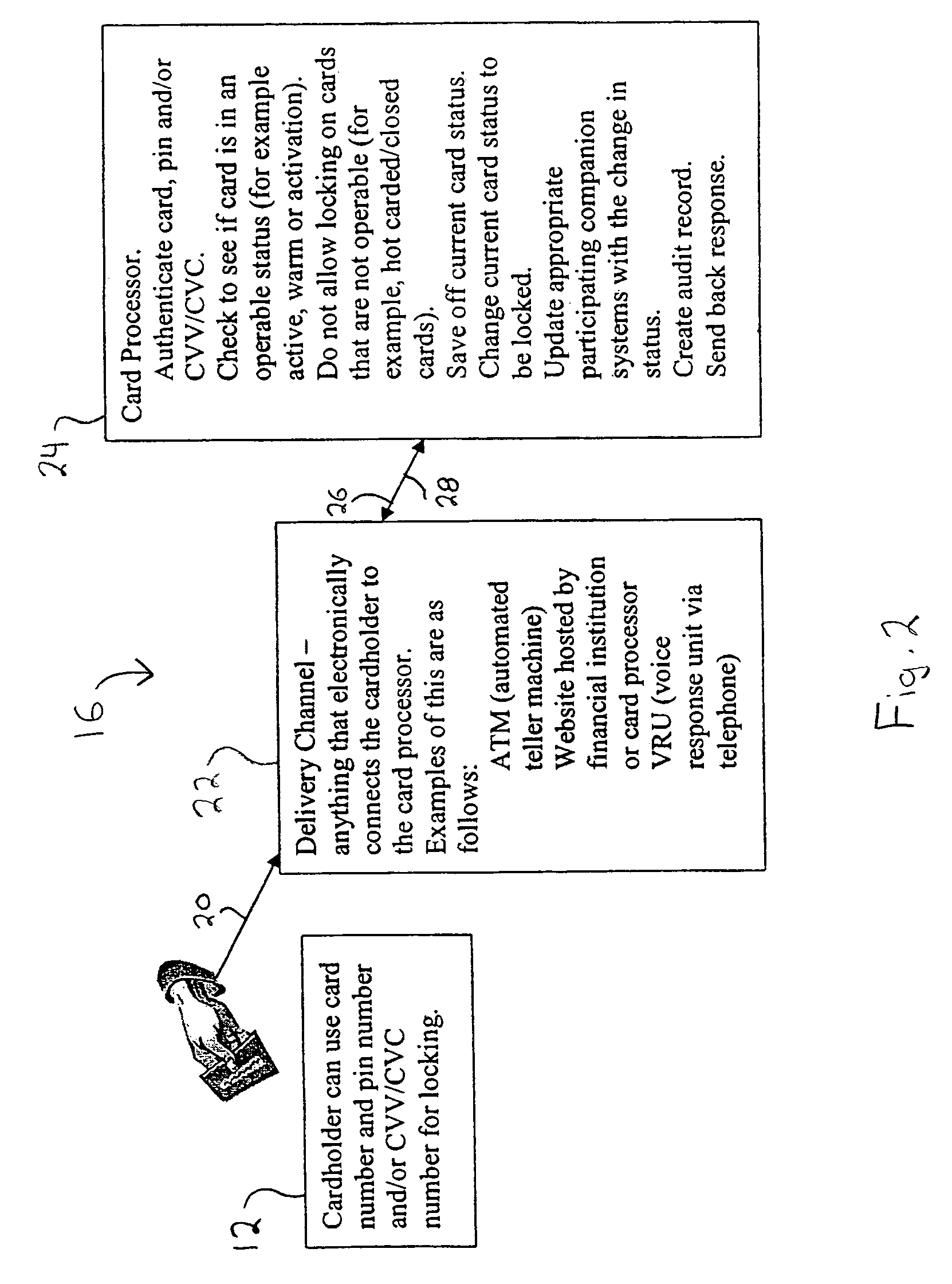

System and method for locking and unlocking a financial account card

Owner:FIDELITY INFORMATION SERVICES LLC

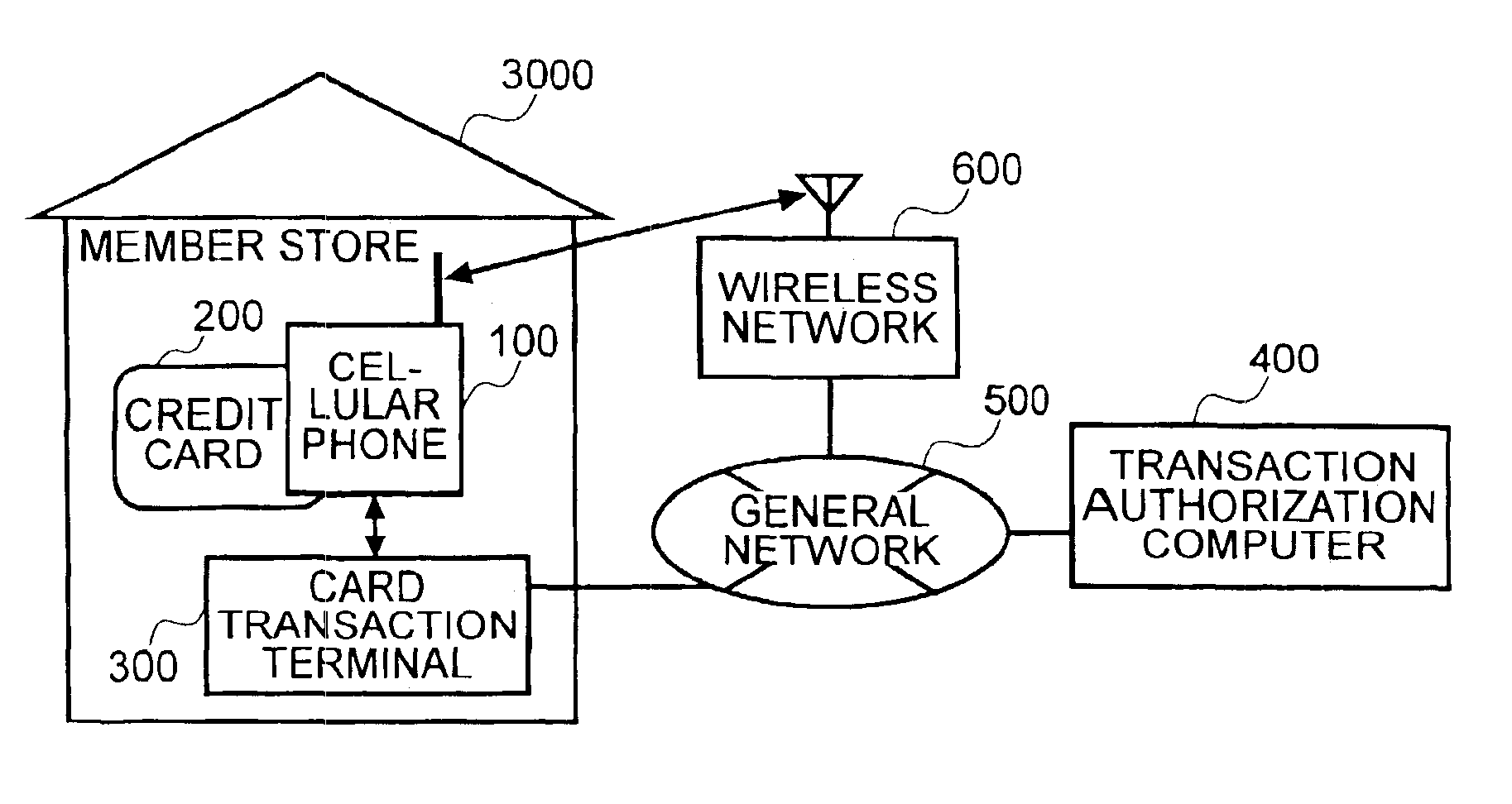

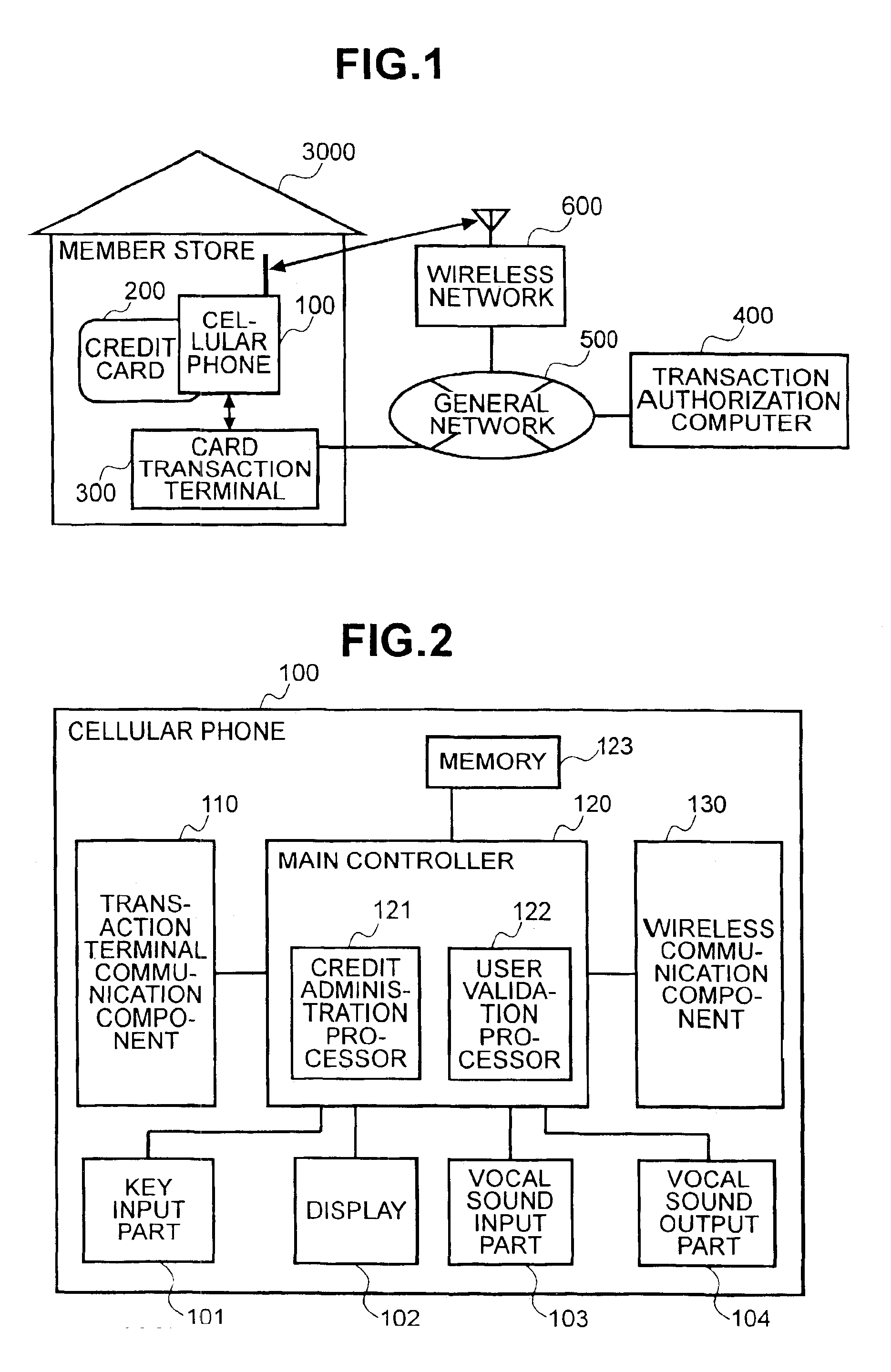

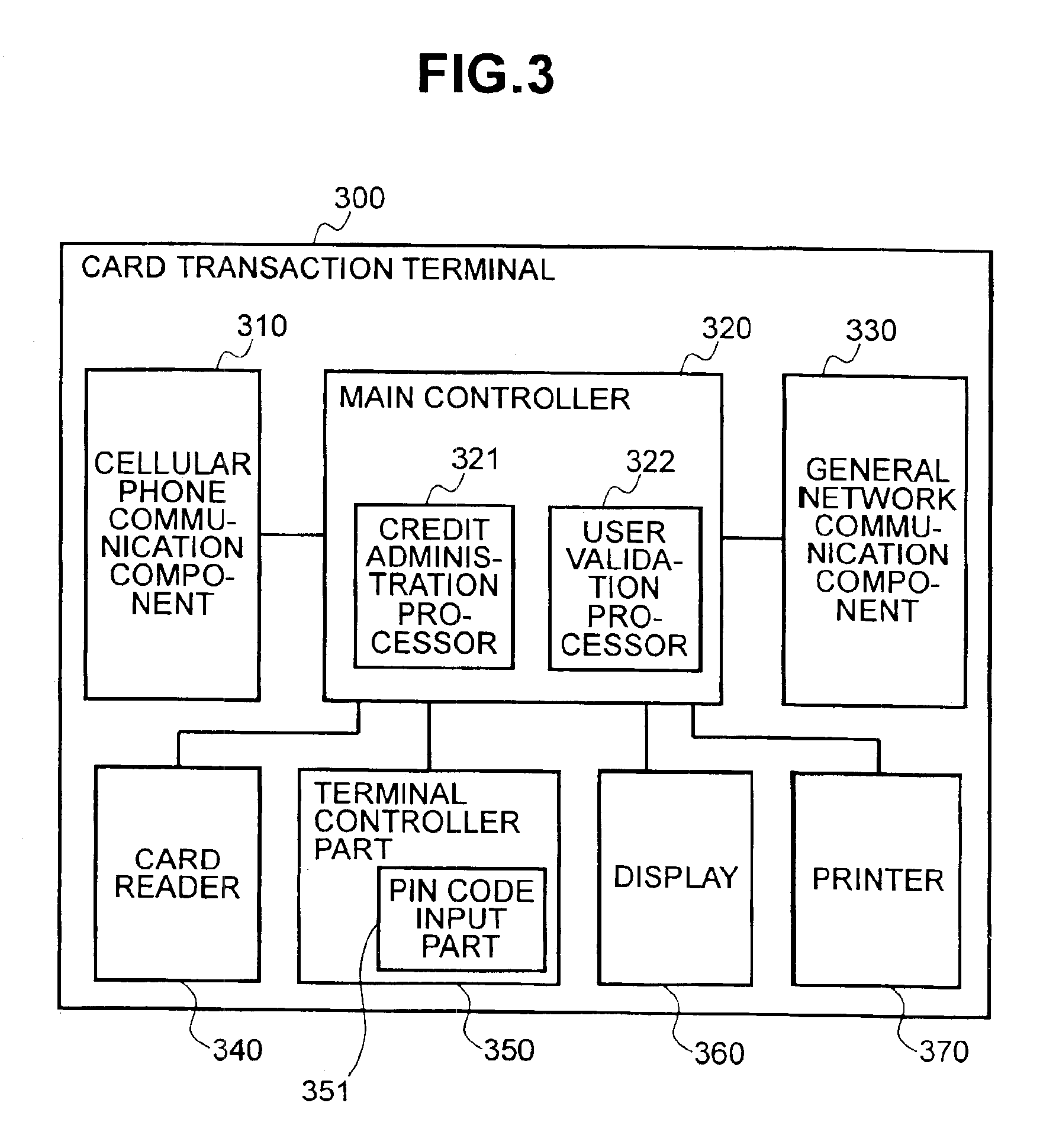

Method and system to prevent fraudulent payment in credit/debit card transactions, and terminals therefor

InactiveUS6913194B2Transaction can be blockedEliminate dangerBuying/selling/leasing transactionsVerifying markings correctnessUser verificationComputer terminal

The present invention enables secure, valid card payments in credit transactions to be performed, preventing fraudulent card use even in cases of loss or theft of a card or of information theft. During a transaction authorization process using a transaction terminal disposed in a credit transaction member store and connected with a host computer, user validation or credit administration is carried out by using a portable communication terminal to input to the host computer identity information which has been previously registered in the portable communication terminal and / or location information for the portable communication terminal.

Owner:MAXELL HLDG LTD

Player Wagering Account and Methods Thereof

ActiveUS20100227670A1Improve balanceCard gamesApparatus for meter-controlled dispensingInvoiceEngineering

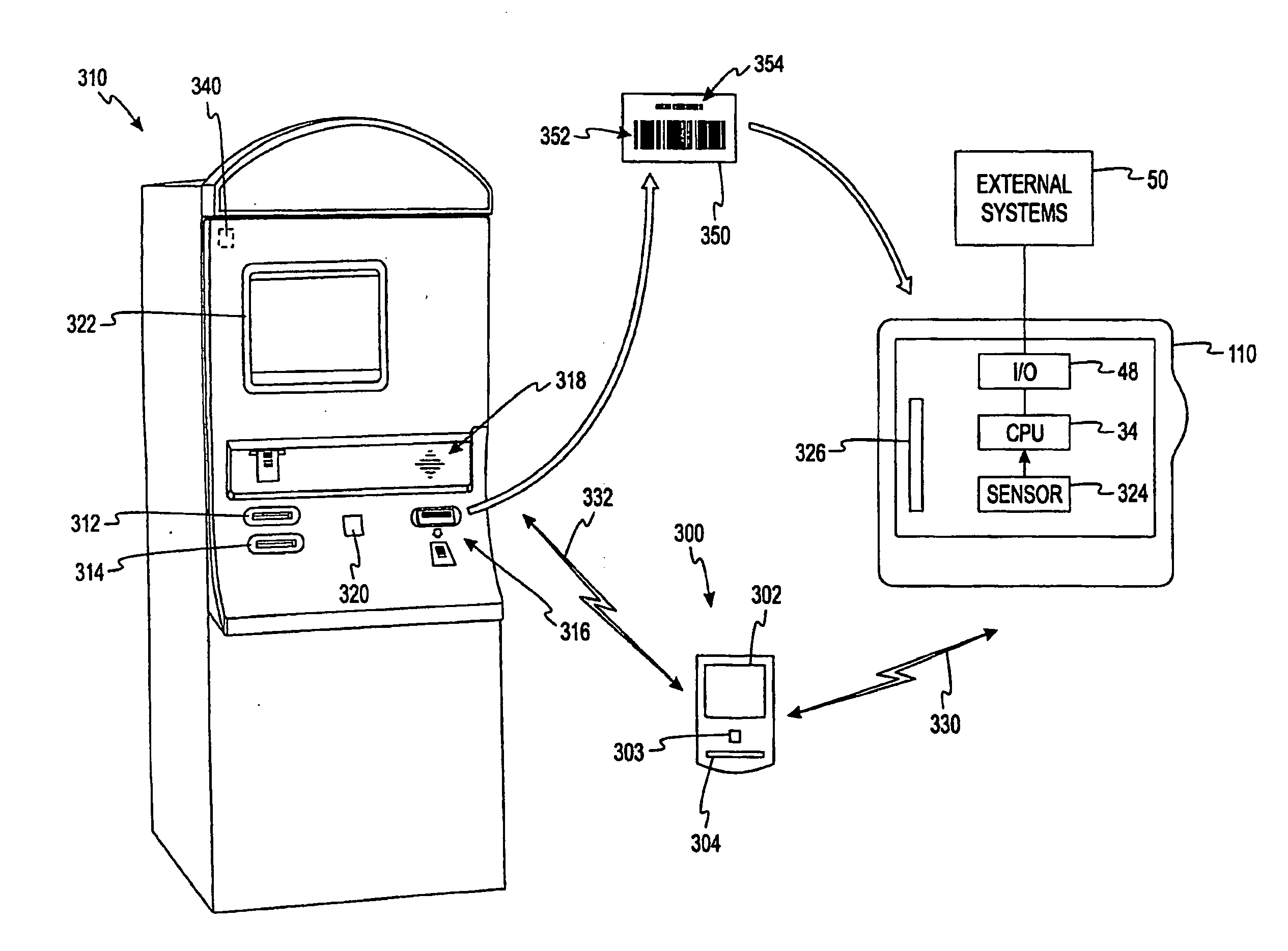

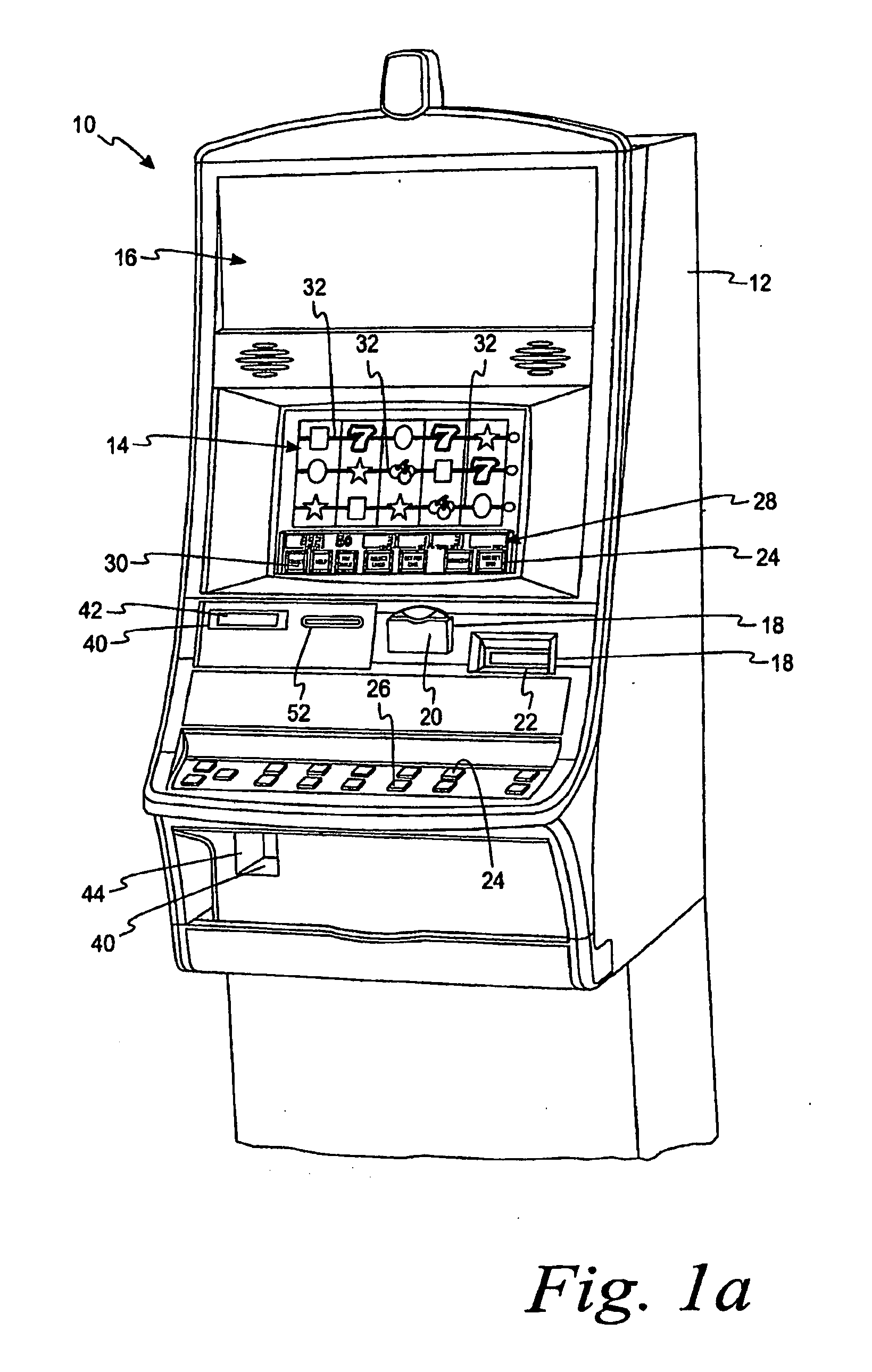

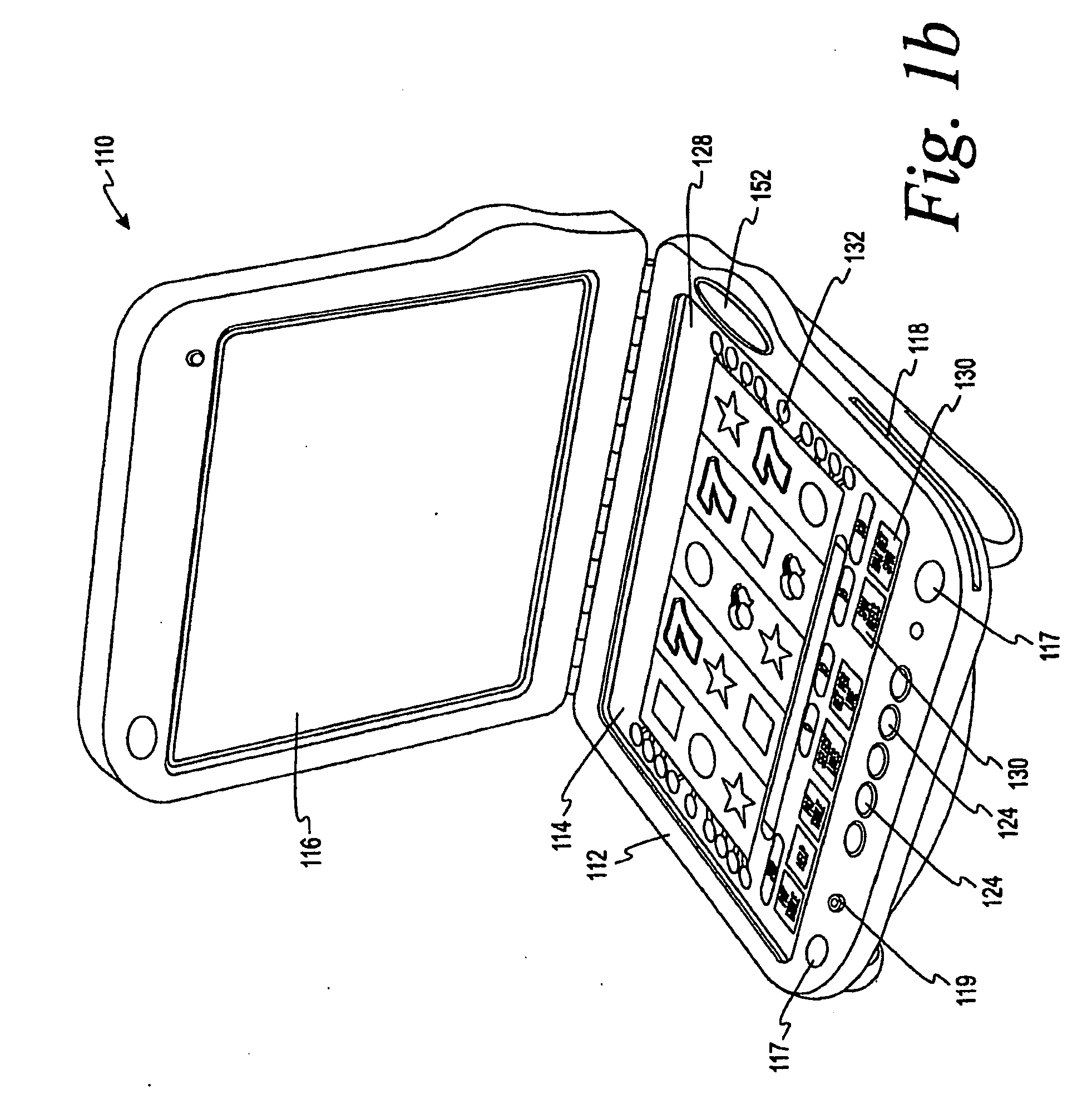

A system for adding funds to a handheld gaming machine. The system includes a portable digital wallet that wirelessly communicates with a handheld gaming machine (“handheld”). The digital wallet stores an amount of funds or funds associated with a remotely stored player account, and is used by the player to add credits to a handheld. The credit meter may be stored remotely, though the player perceives that the funds are actually being transferred via the digital wallet. Other funding techniques include a kiosk that accepts cash or credit / debit cards and dispenses tickets or other media that encodes information representing an amount of funds. The player uses this media to add credits to the handheld. The media may be player-dependent such that the player's identity is somehow linked to the media or it may be player-agnostic such that the player's identity is not linked to the funds associated with the media.

Owner:LNW GAMING INC

Secure card-based transactions using mobile phones or other mobile devices

InactiveUS20120284194A1Easily and quickly encodedProvide securityFinancePayment architectureSmart cardMobile device

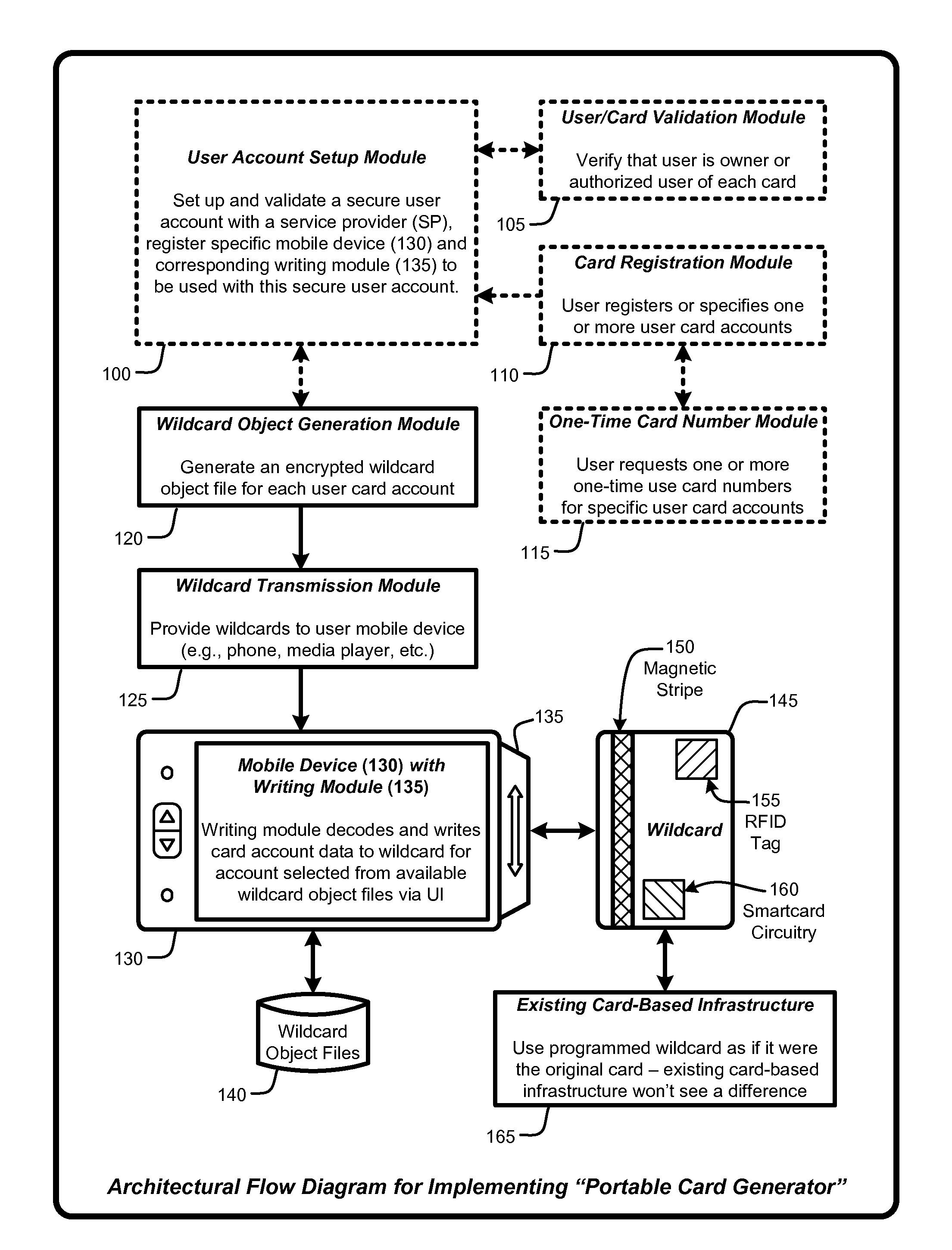

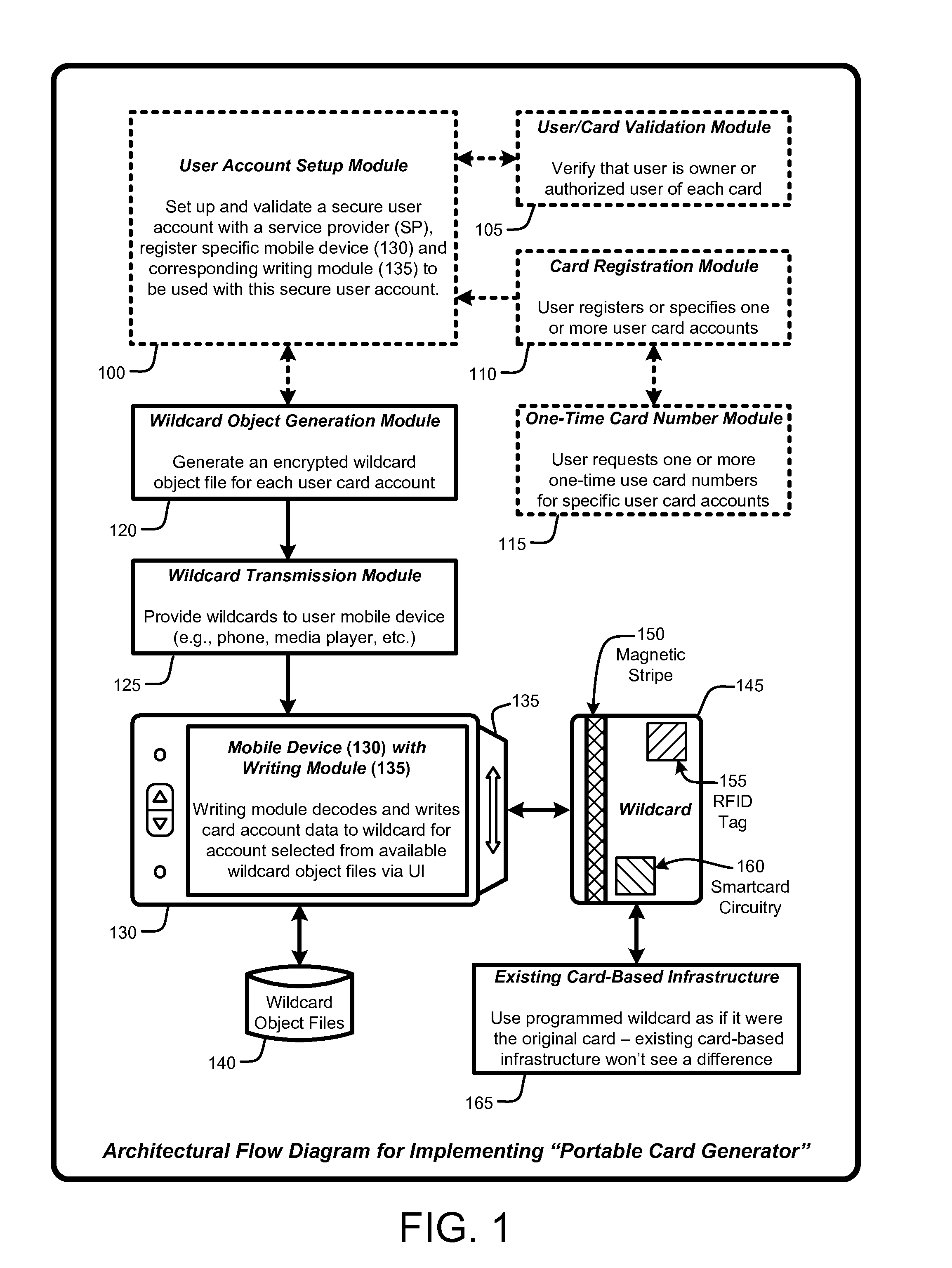

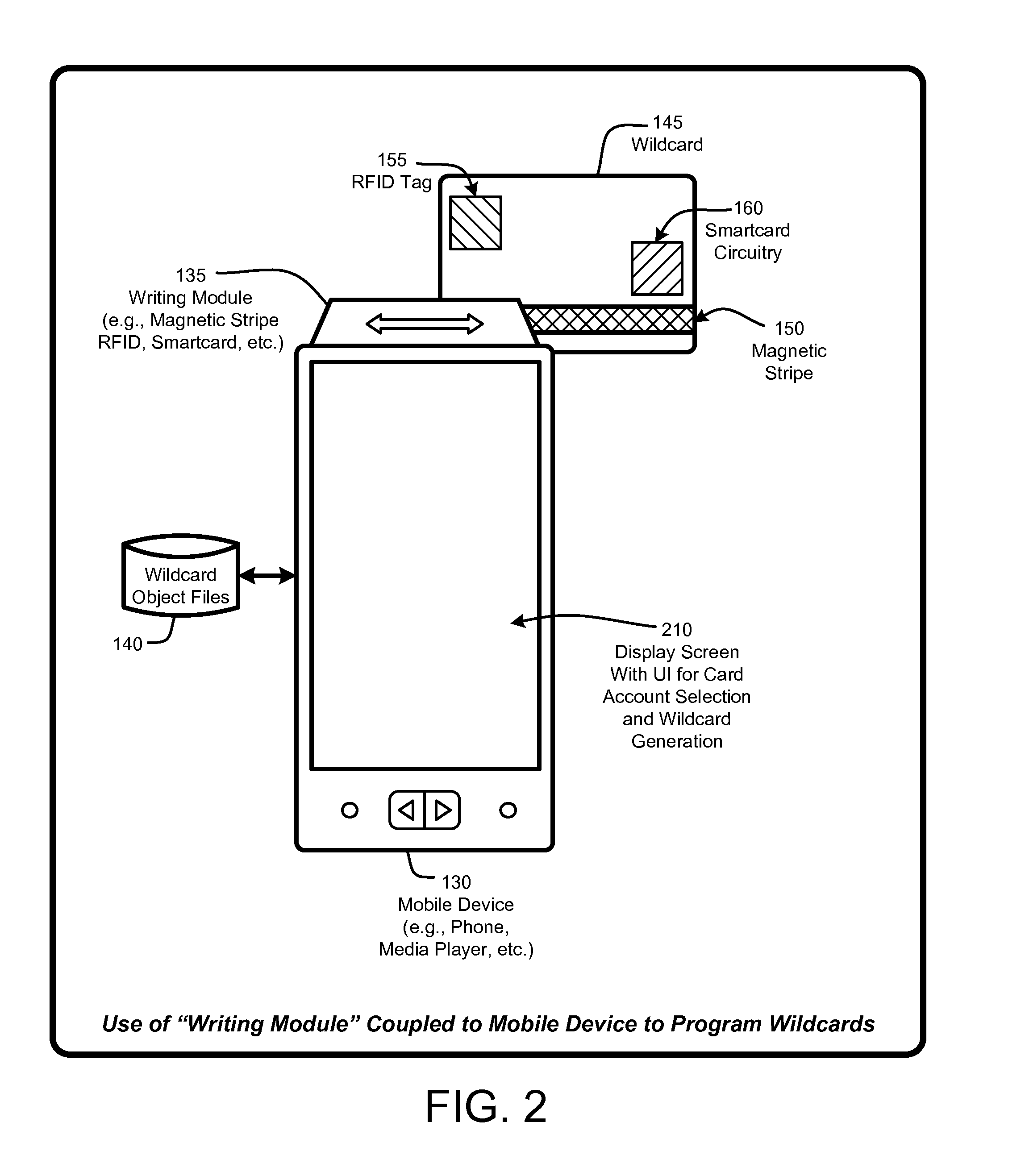

A “Portable Card Generator” is implemented within a portable device, such as a mobile phone, and provides various techniques for writing secure account information from user selected accounts to a “wildcard” having rewritable magnetic stripes, rewritable RFID tags, and / or rewritable smartcard circuitry. The account information is retrieved by the portable device from local or remote stores of user accounts. Once that account information is written, the wildcard is then available for immediate use for credit card or debit-type payments, loyalty card use, etc. Consequently, by providing a credit card sized object having a rewriteable magnetic stripe, RFID tag, and / or smartcard circuitry, in combination with account information for various credit cards, debit cards, consumer loyalty cards, insurance cards, ID cards or badges, etc., the user is no longer required to physically carry those cards in order to use the corresponding accounts within existing card-based infrastructures.

Owner:MICROSOFT TECH LICENSING LLC

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com