Patents

Literature

214 results about "Stored-value card" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

A stored-value card (SVC) is a payment card with a monetary value stored on the card itself, not in an external account maintained by a financial institution. This means no network access is required by the payment collection terminals as funds can be withdrawn and deposited straight from the card. Like cash, payment cards can be used anonymously as the person holding the card can use the funds. They are an electronic development of token coins and are typically used in low value payment systems or where network access is difficult or expensive to implement, such as parking machines, public transport systems, closed payment systems in locations such as ships or within companies.

Methods and Systems For Making a Payment Via A Stored Value Card in a Mobile Environment

ActiveUS20080040265A1Unprecedented convenienceUnprecedented flexibilityFinanceBilling/invoicingFinancial transactionMobile context

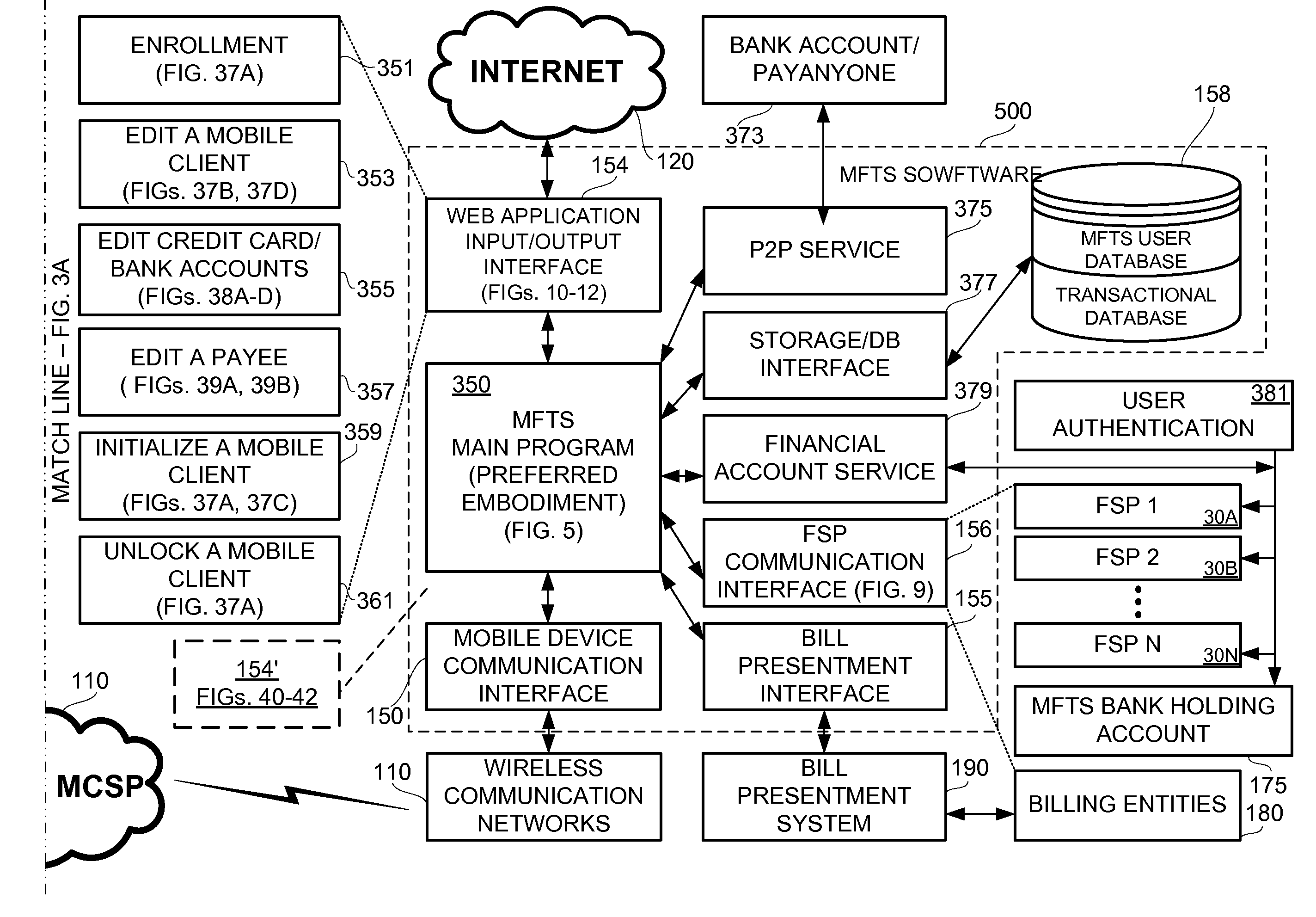

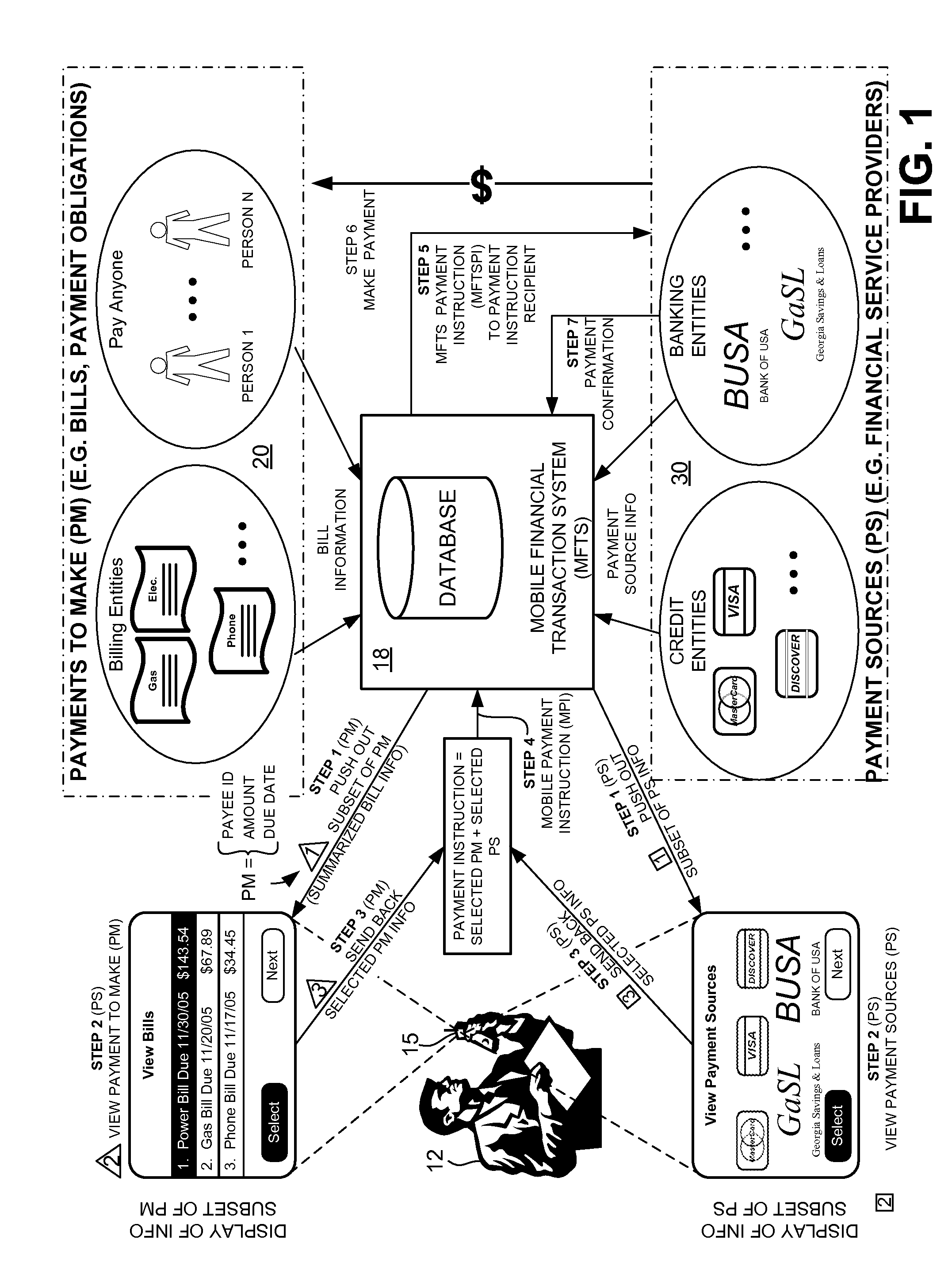

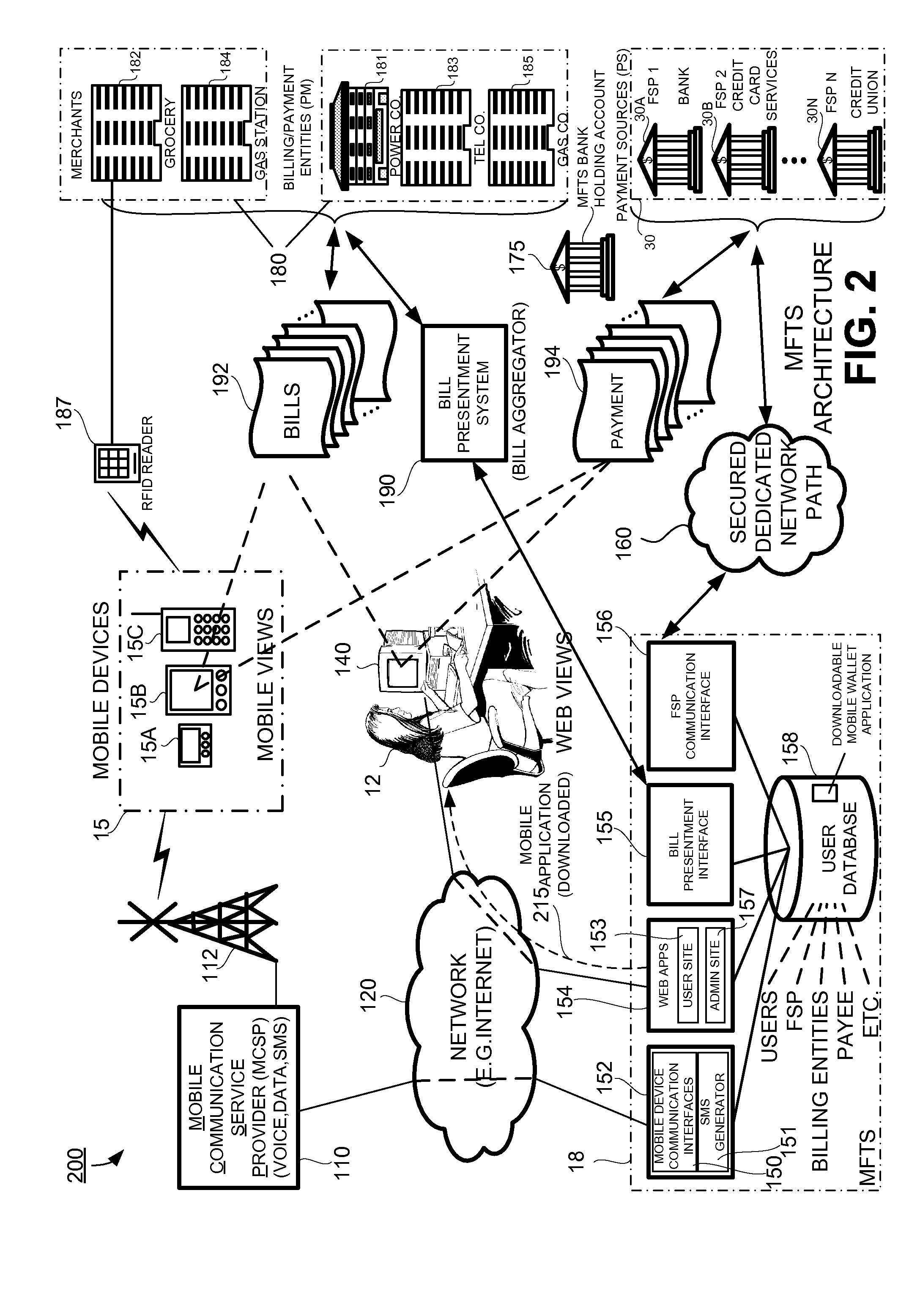

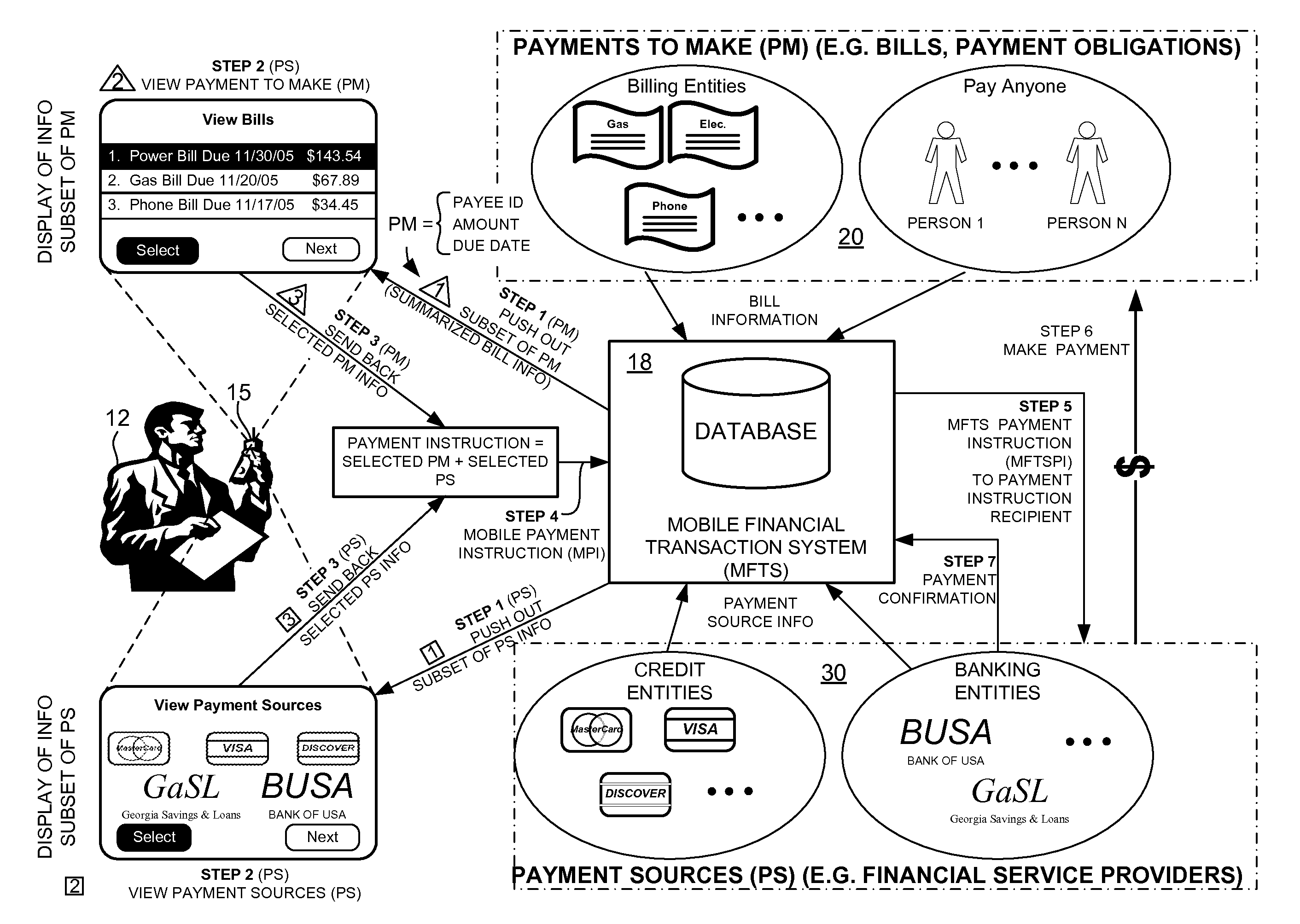

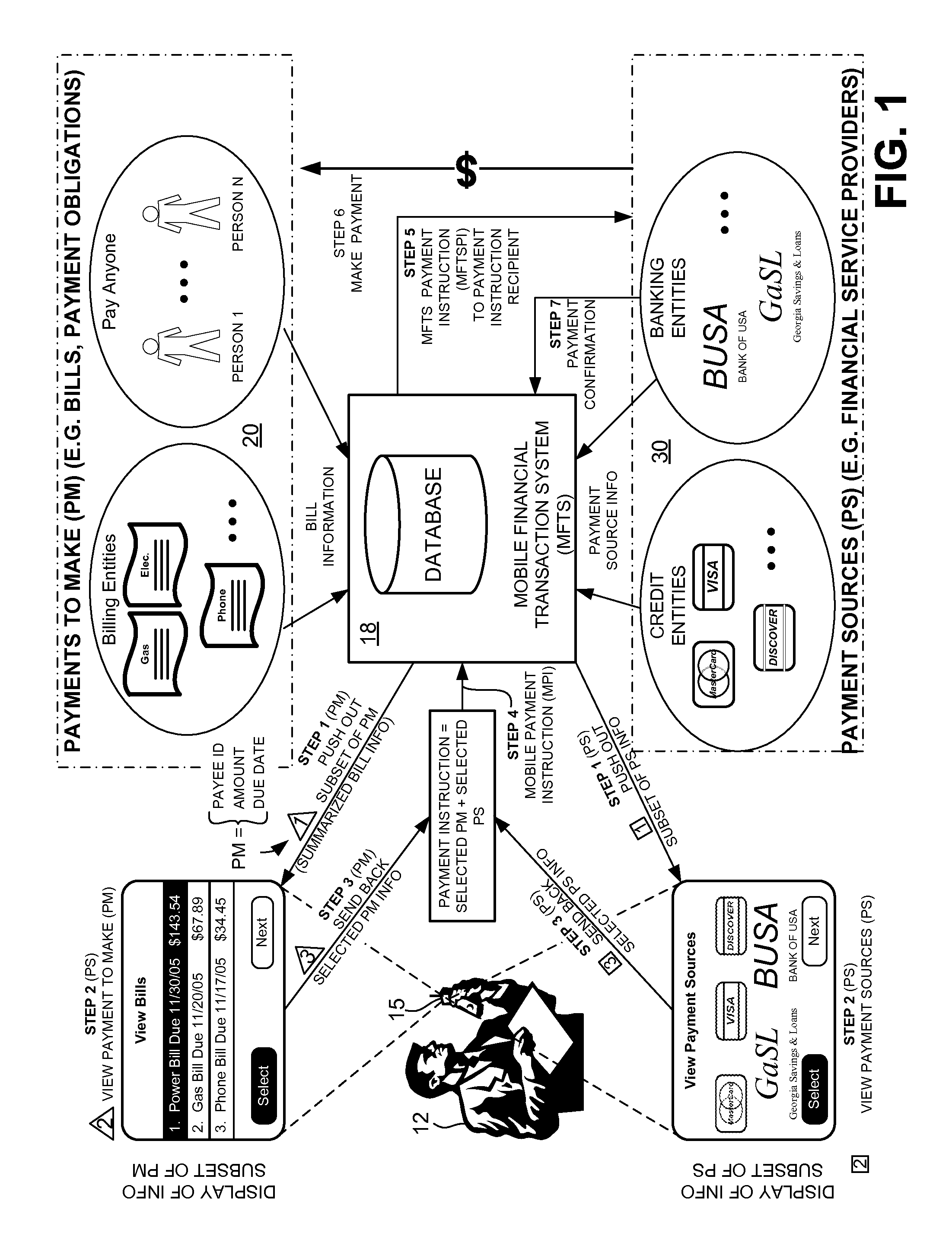

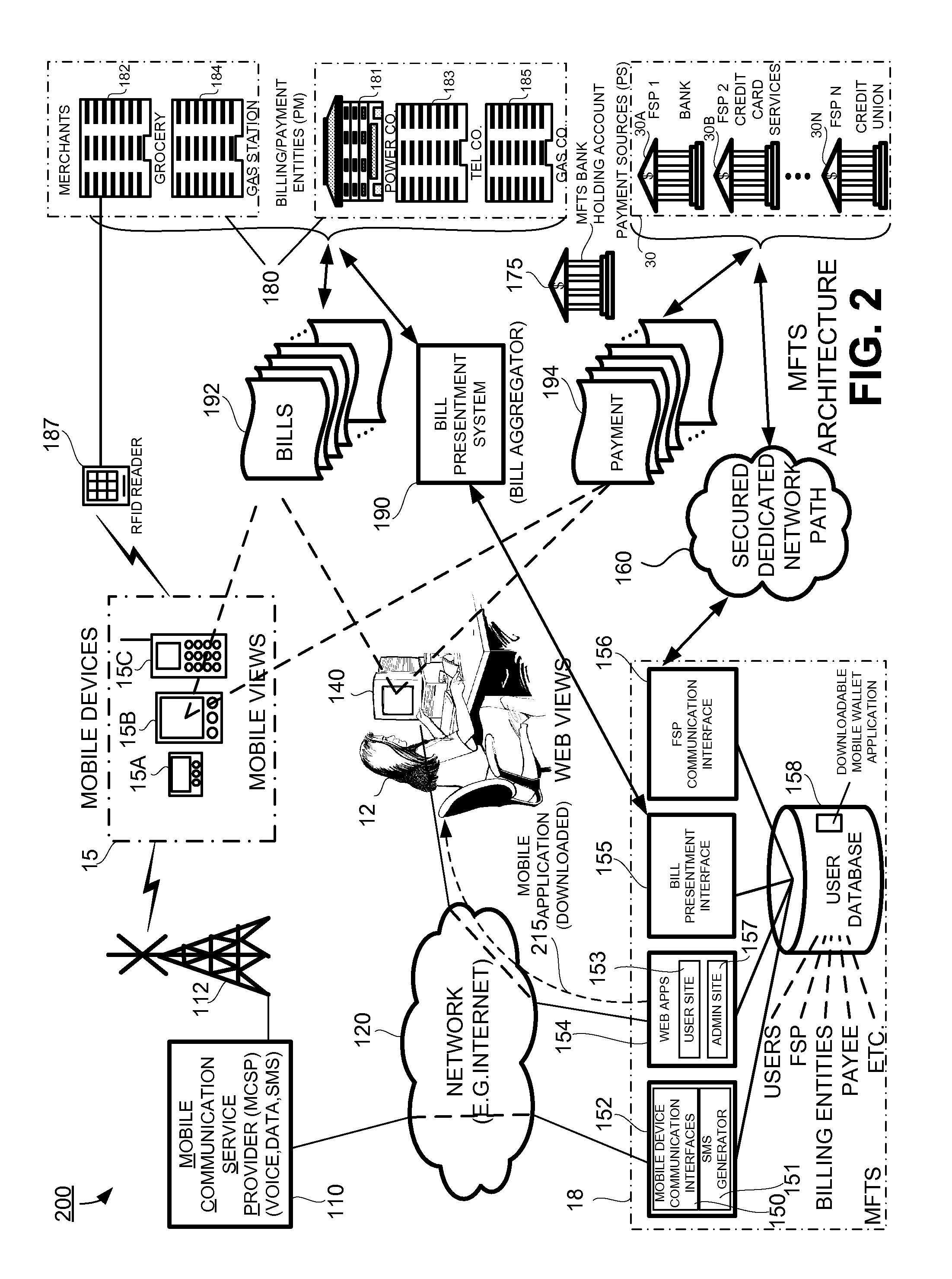

Methods and systems for making a financial payment to a payee via a stored value (SV) card utilizing a mobile device such as a mobile telephone (cellphone) or wireless connected personal digital assistant (PDA). The mobile device communicates wirelessly with a mobile financial transaction system (MFTS) that stores user information and transaction information. A user enters information via the mobile device identifying a payee and indicating a stored value card payment method. The mobile device generates a mobile payment instruction that includes information corresponding to the identified payee and indicating a stored value card payment method. The mobile payment instruction is wirelessly communicated to the MFTS. The MFTS generates an MFTS payment instruction to a payment instruction recipient that can issue a new stored value card and / or reload funds onto a pre-existing stored value card. The MFTS communicates the MFTS payment instruction to the payment instruction recipient, which arranges for payment to the identified payee by issuing a new stored value card or reloading funds onto a pre-existing stored value card.

Owner:QUALCOMM INC

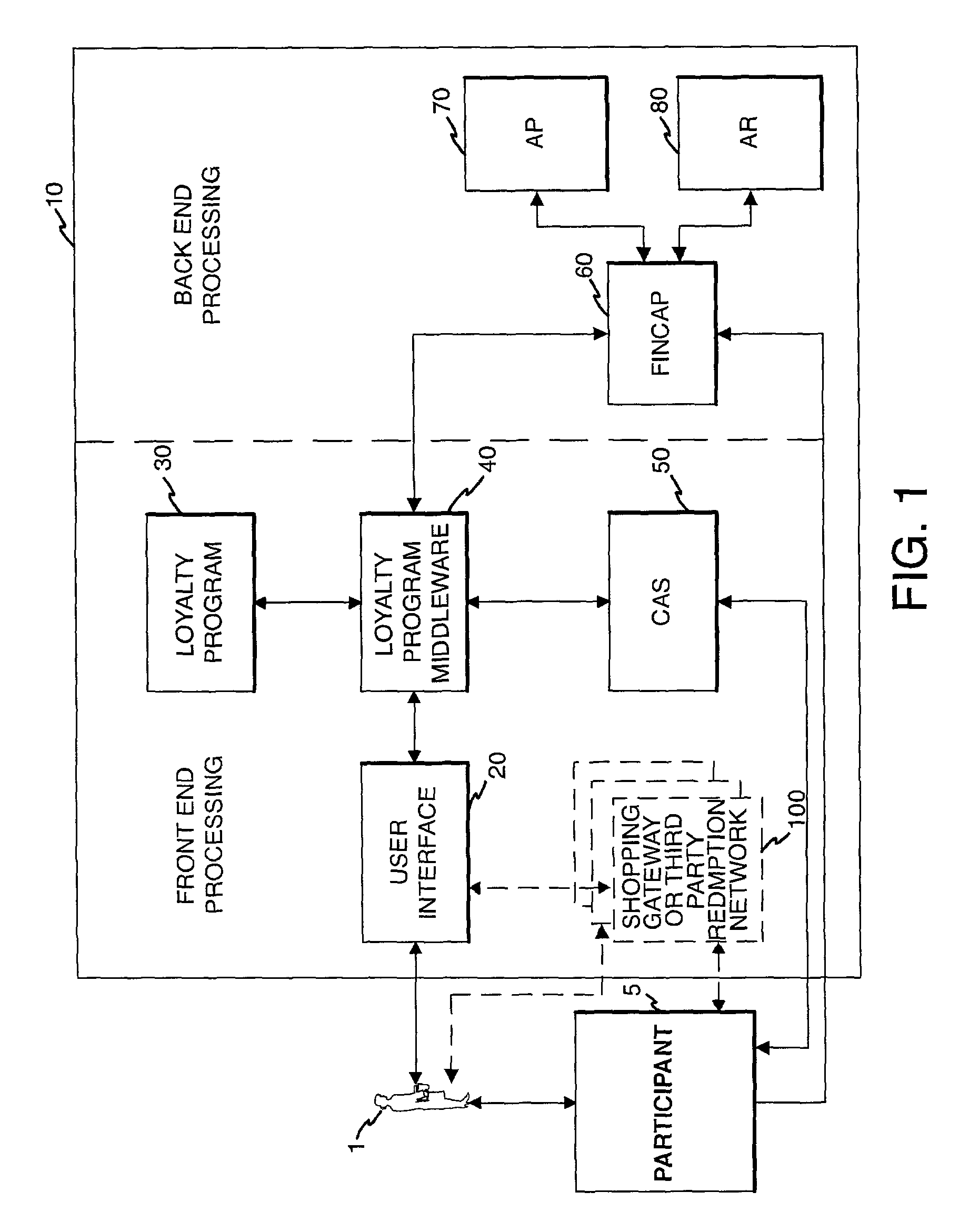

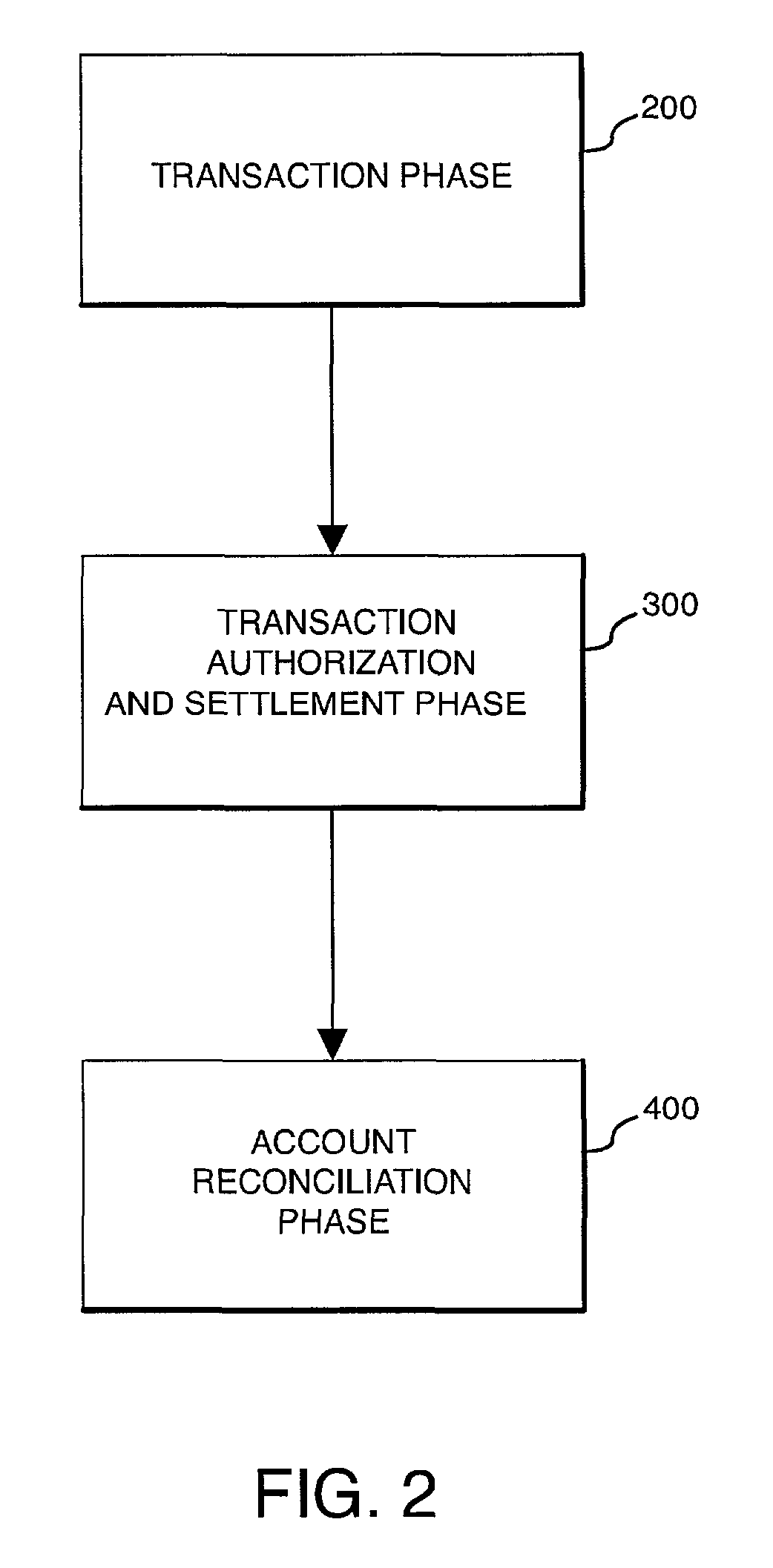

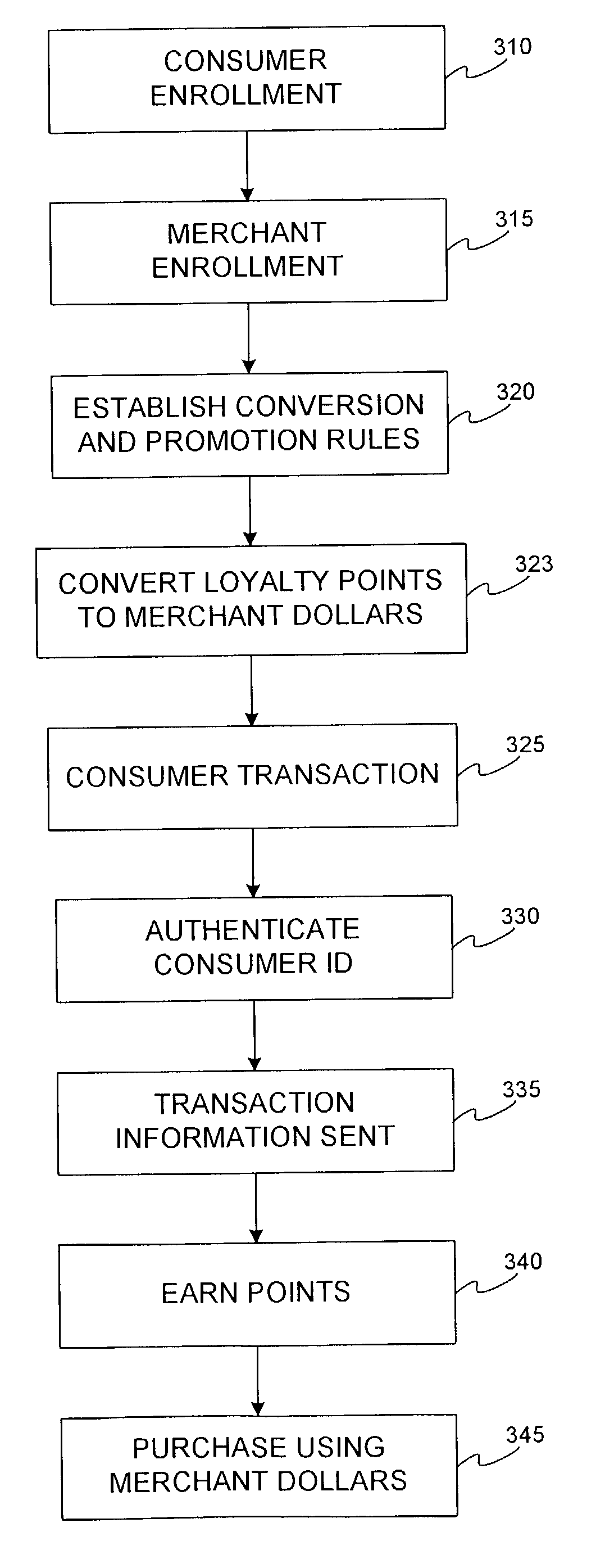

System and method for using loyalty rewards as currency

InactiveUS8046256B2Convenient transactionFinancePayment circuitsLoyalty programFinancial transaction

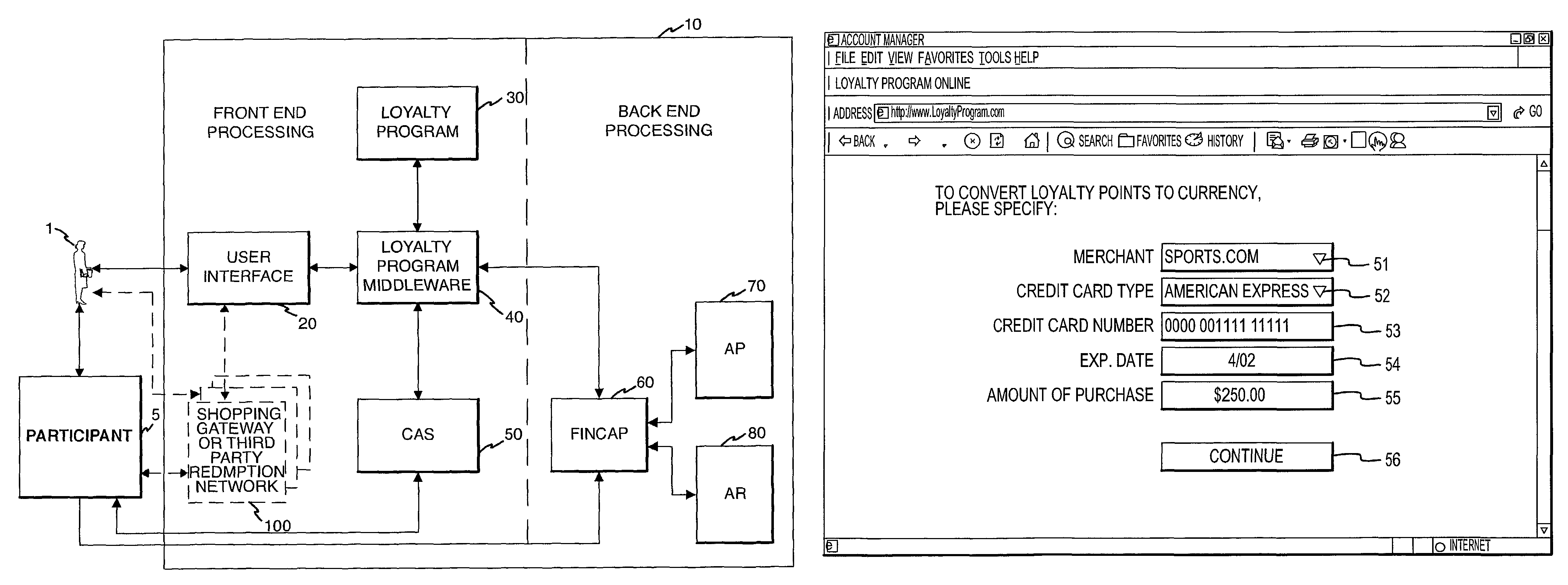

The present invention involves spending loyalty points over a computerized network to facilitate a transaction. With this system, a loyalty program participant is able to use an existing transaction card to purchase an item over a computerized network, while at the same time offsetting the cost of that transaction by converting loyalty points to a currency value credit and having the credit applied to the participant's financial transaction account. Currency credit from converted loyalty points may also be applied to stored value cards, online digital wallet accounts and the like. Further, currency credit may also be applied to other accounts to effect a gift or donation.

Owner:LIBERTY PEAK VENTURES LLC

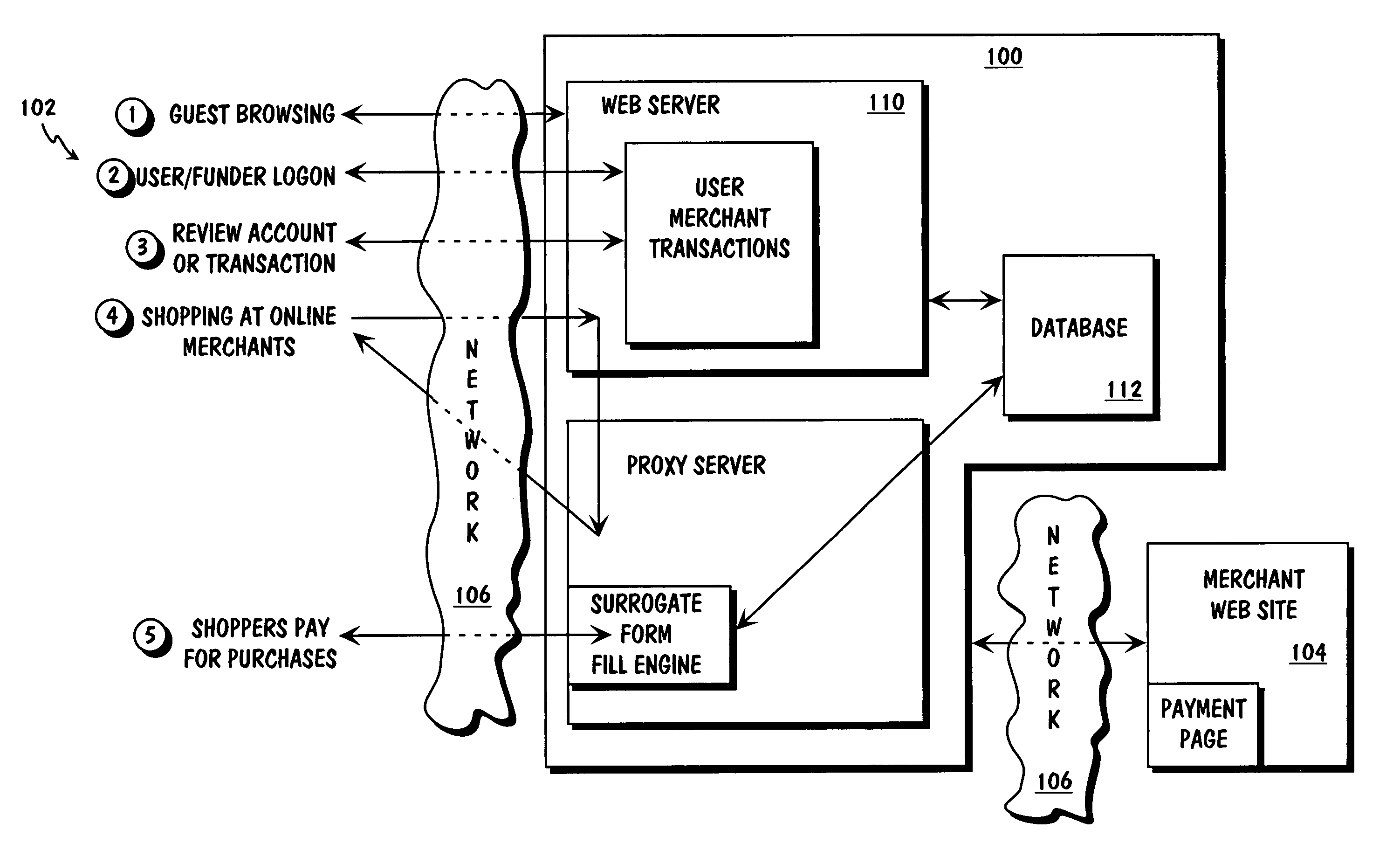

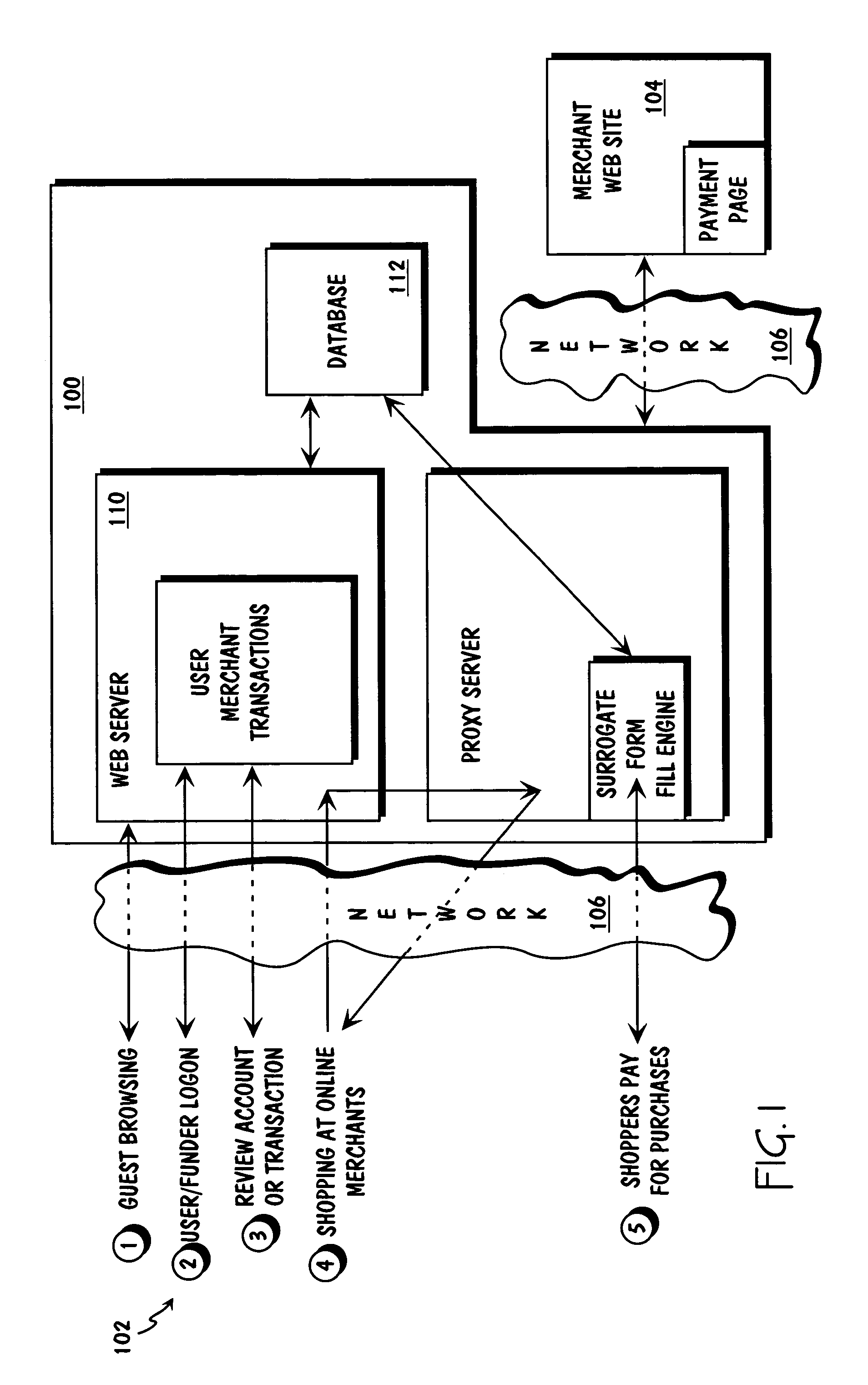

Method and apparatus for surrogate control of network-based electronic transactions

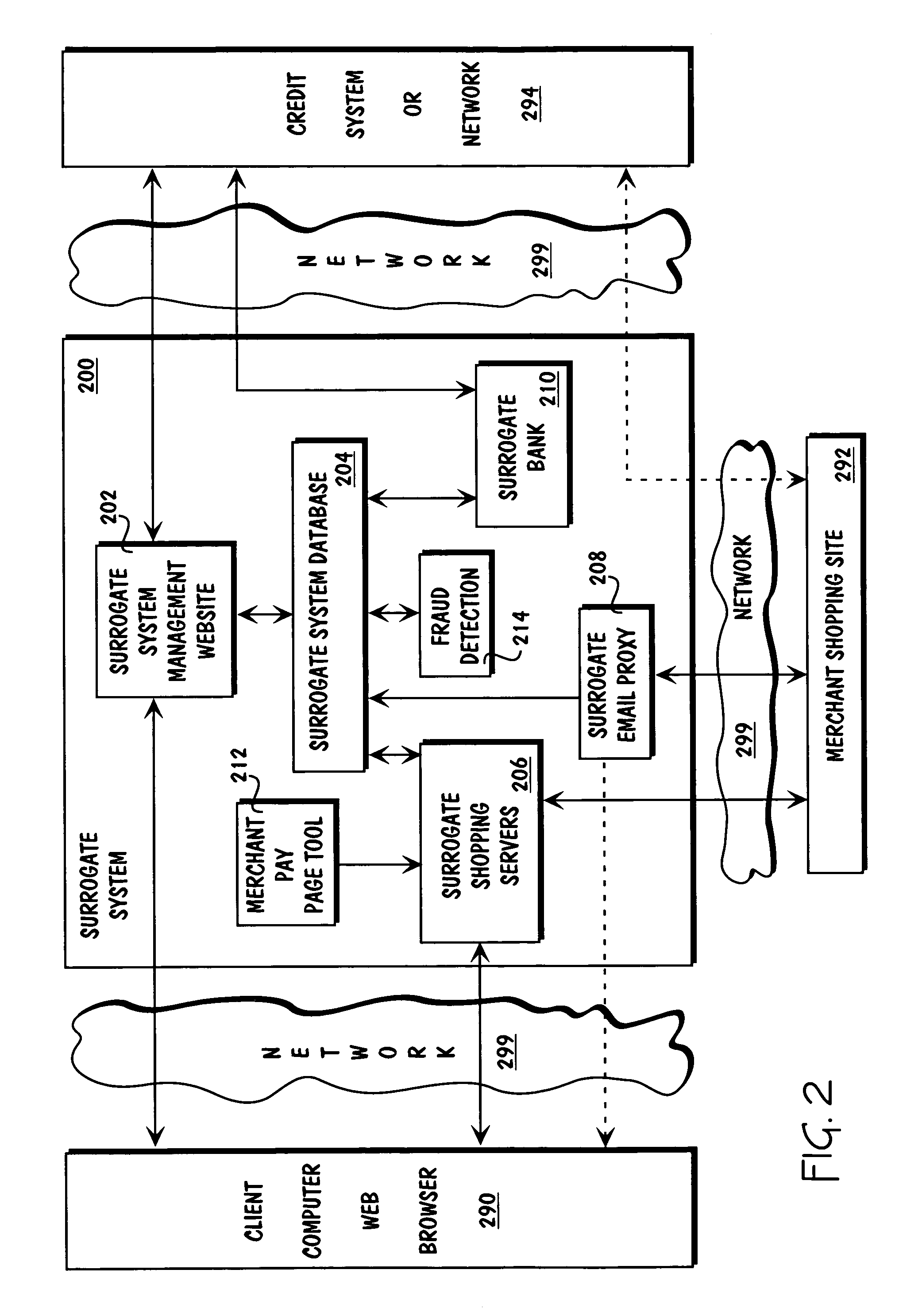

A surrogate system for the transparent control of electronic commerce transactions is provided through which an individual without a credit card is enabled to shop at online merchant sites. Upon opening an account within the surrogate system, the account can be funded using numerous fund sources, for example credit cards, checking accounts, money orders, gift certificates, incentive codes, online currency, coupons, and stored value cards. A user with a funded account can shop at numerous merchant web sites through the surrogate system. When merchandise is selected for purchase, a purchase transaction is executed in which a credit card belonging to the surrogate system is temporarily or permanently assigned to the user. The credit card, once loaded with funds from the user's corresponding funded account, is used to complete the purchase transaction. The surrogate system provides controls that include monitoring the data streams and, in response, controlling the information flow between the user and the merchant sites.

Owner:THE COCA-COLA CO

Identity theft and fraud protection system and method

ActiveUS20070083460A1Prevent theftMaximum anonymityFinanceDigital data protectionCredit cardEmail address

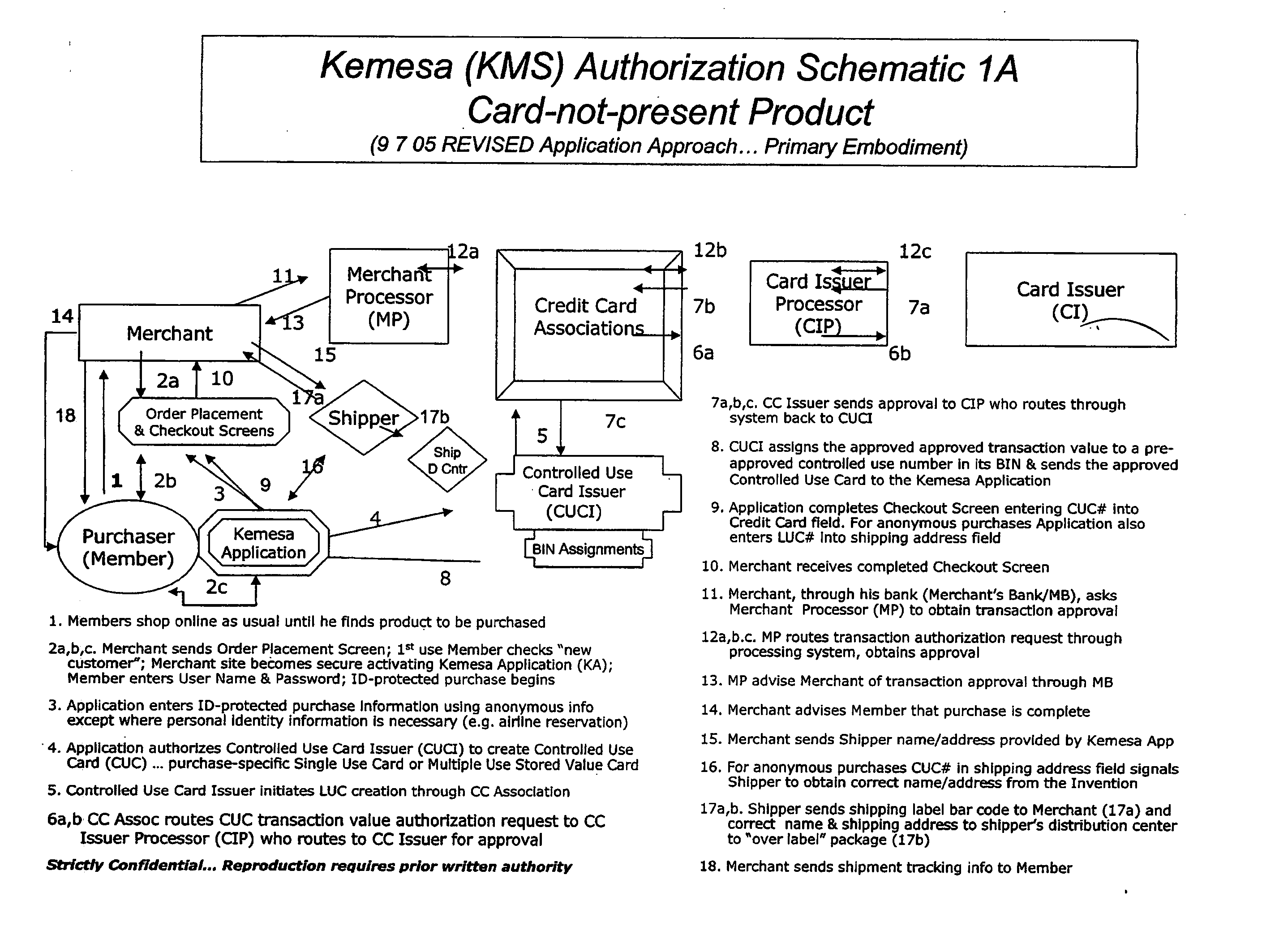

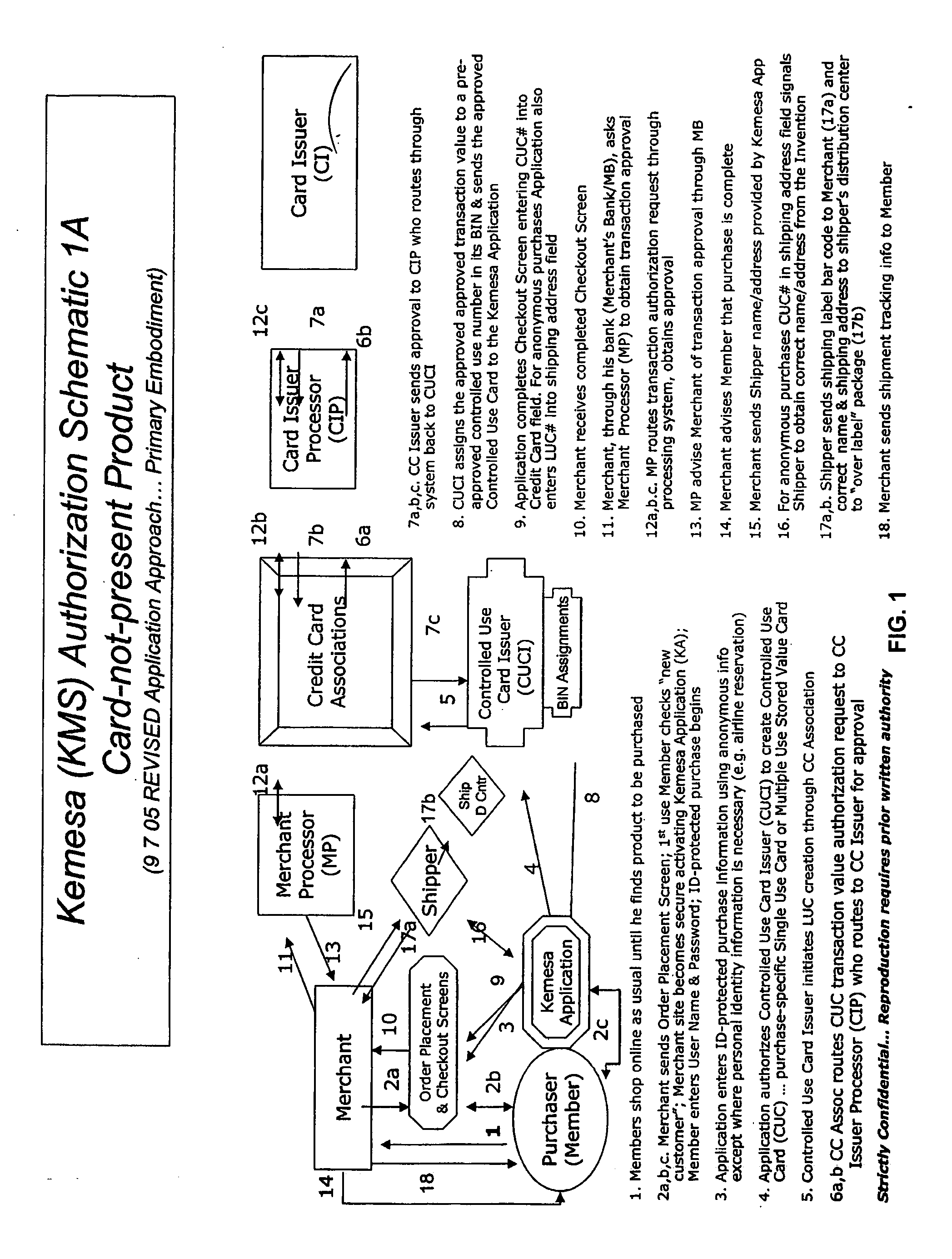

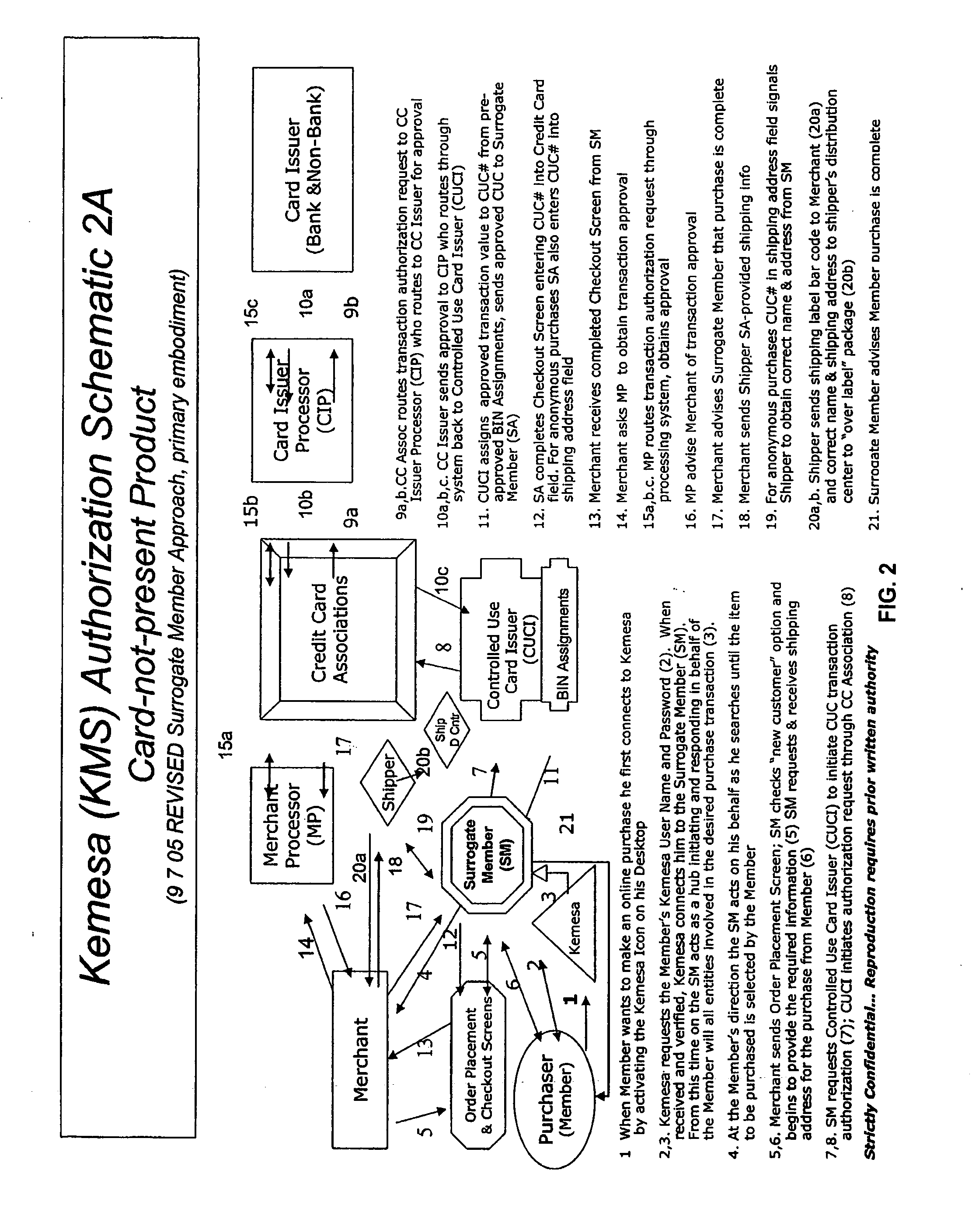

A system and method for preventing personal identity theft when making online and offline purchases requires a purchaser to first subscribe and become a member user by registering and providing relevant personal identity information. Once registered, the member is assigned a user name and a password. The subscribing member's personal identity information is then encrypted and stored at one or more highly secure locations. The ID protection system obtains a controlled use card (CUC) through a CUC issuer on behalf of the member for use to make each purchase transaction. The CUC is anonymous with respect to user (member) identity and may be a purchase-specific single-use card or a multiple-use stored value card with no traceable connection to any other financial account. When the member makes a secure online purchase, the system software enters anonymous information (i.e. not revealing the member's real name, email address, billing information, etc.) on the merchant's order placement screen, except in instances where the member's real identity information is required (e.g. airline tickets). The merchant receives the completed checkout screen, obtains credit approval through a credit card association, and sends the shipping information to a shipper which independently obtains the correct shipping name and address from the ID protection system prior to shipping the purchased product(s).

Owner:VIPR SYST +1

Methods for providing cardless payment

ActiveUS7099850B1Convenient and easy to rememberConvenient and/orPublic key for secure communicationPayment protocolsComputer hardwareThe Internet

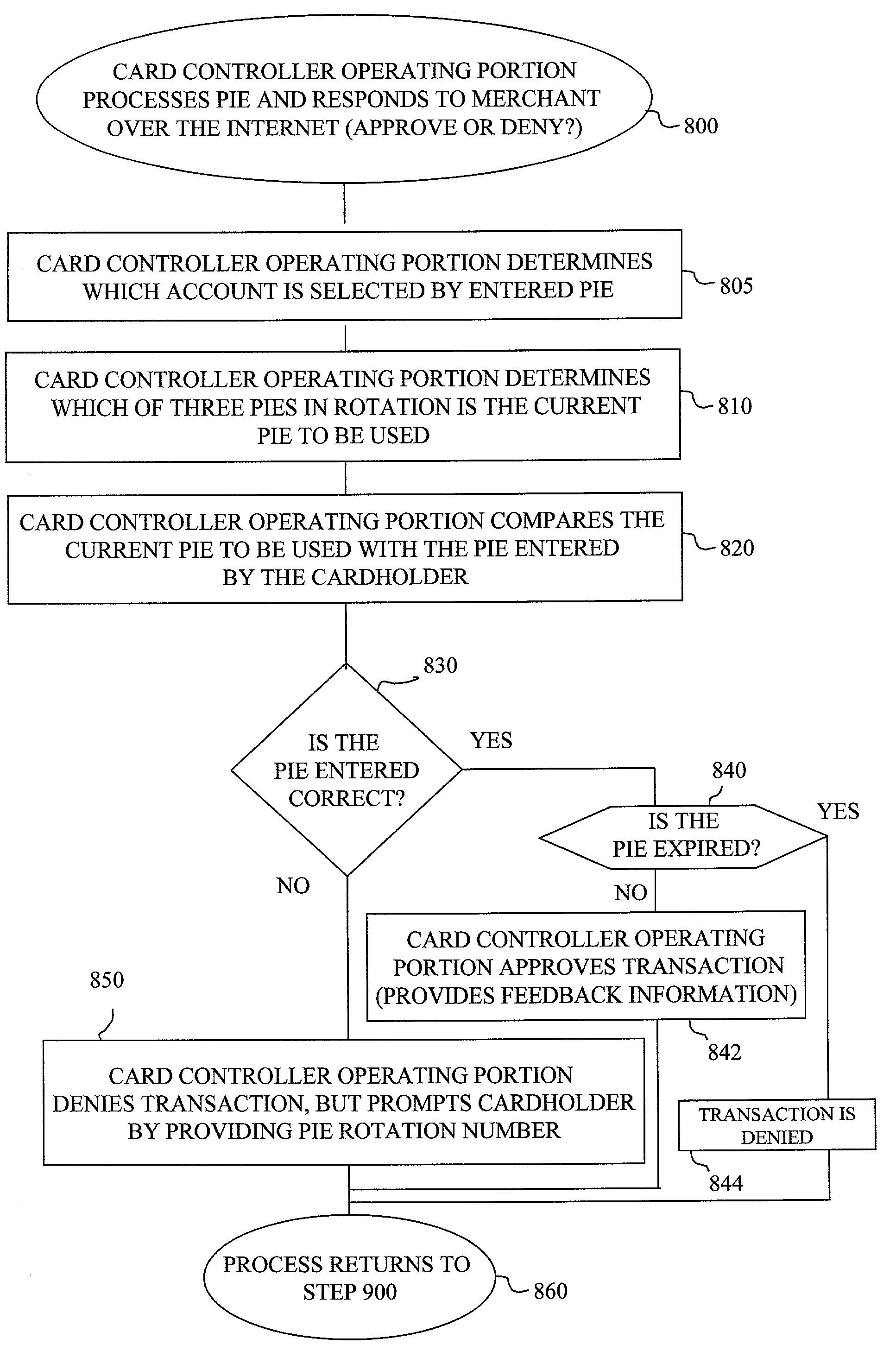

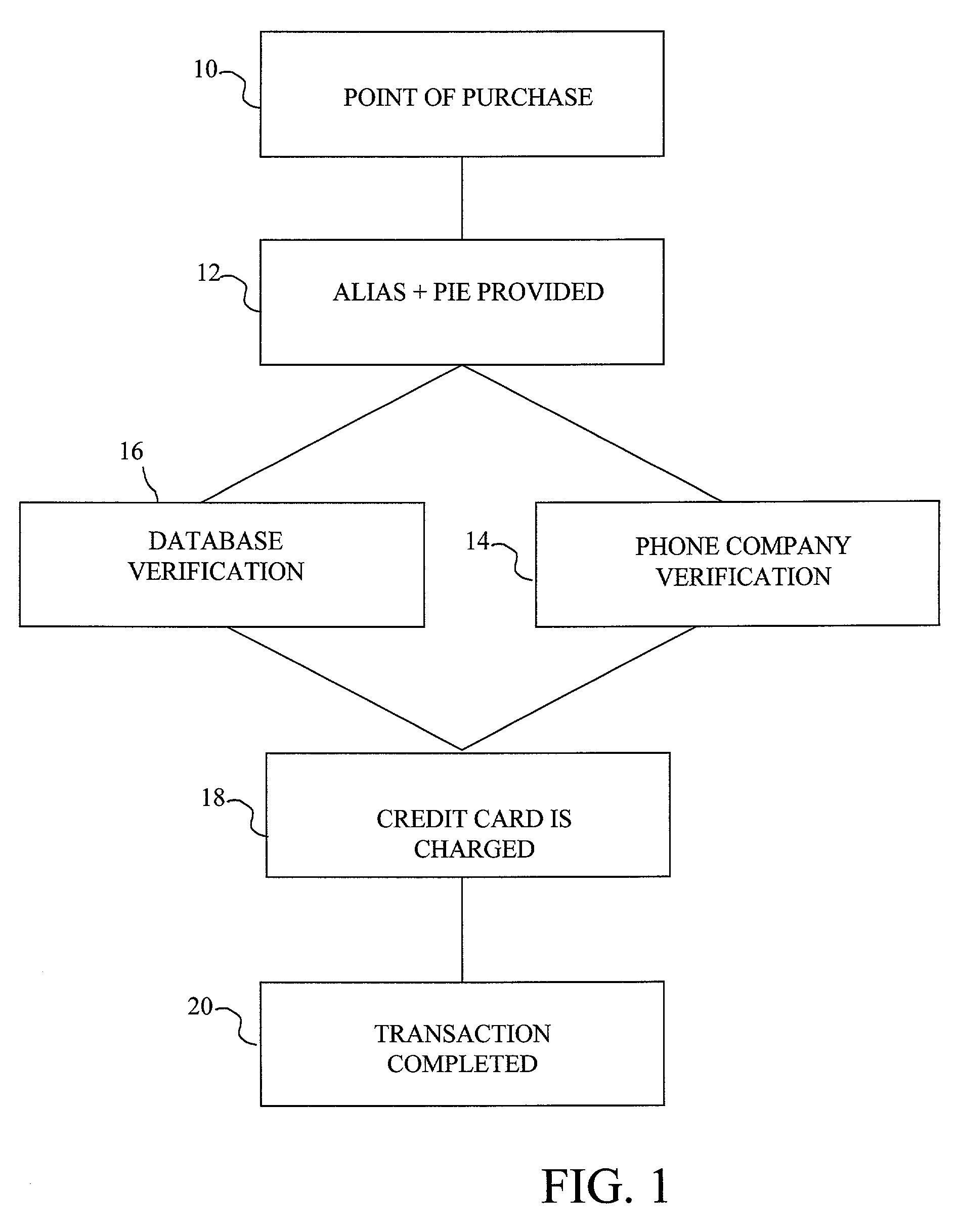

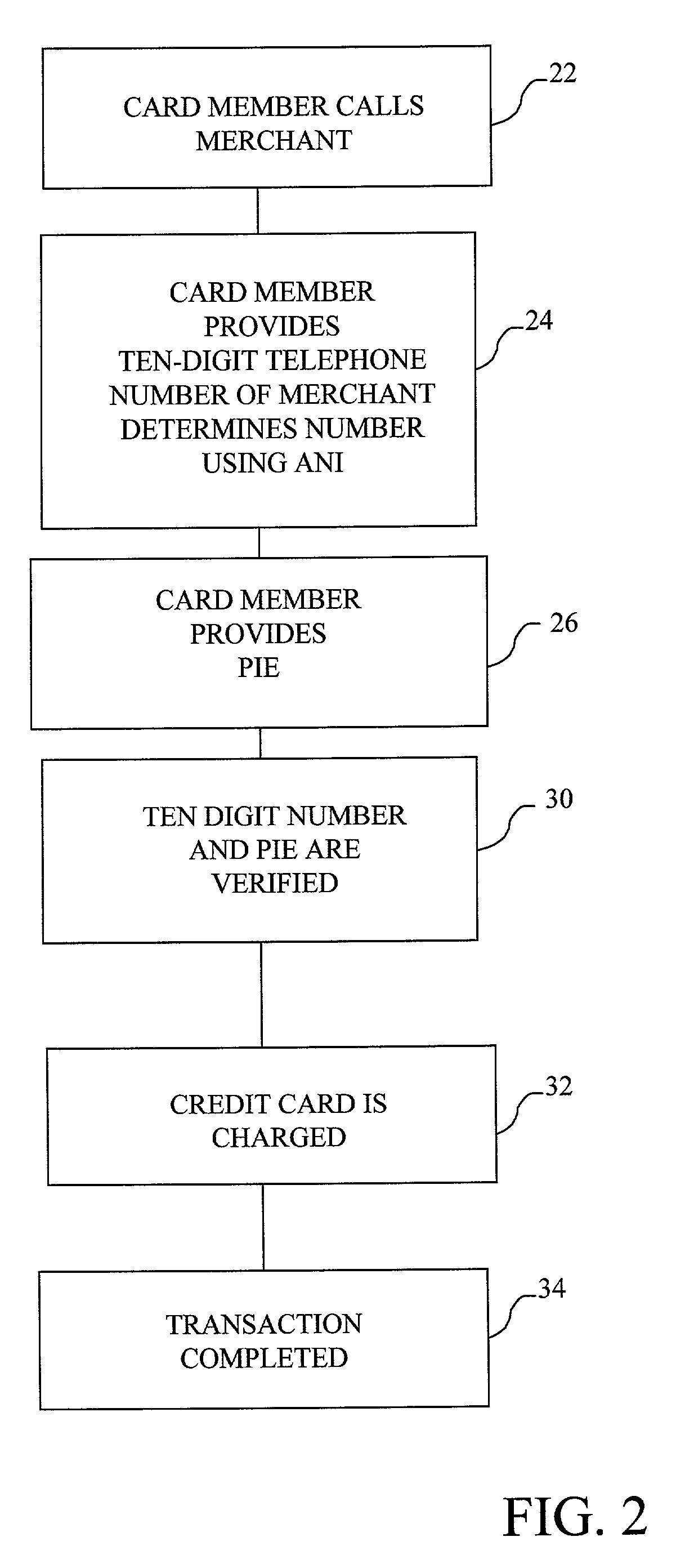

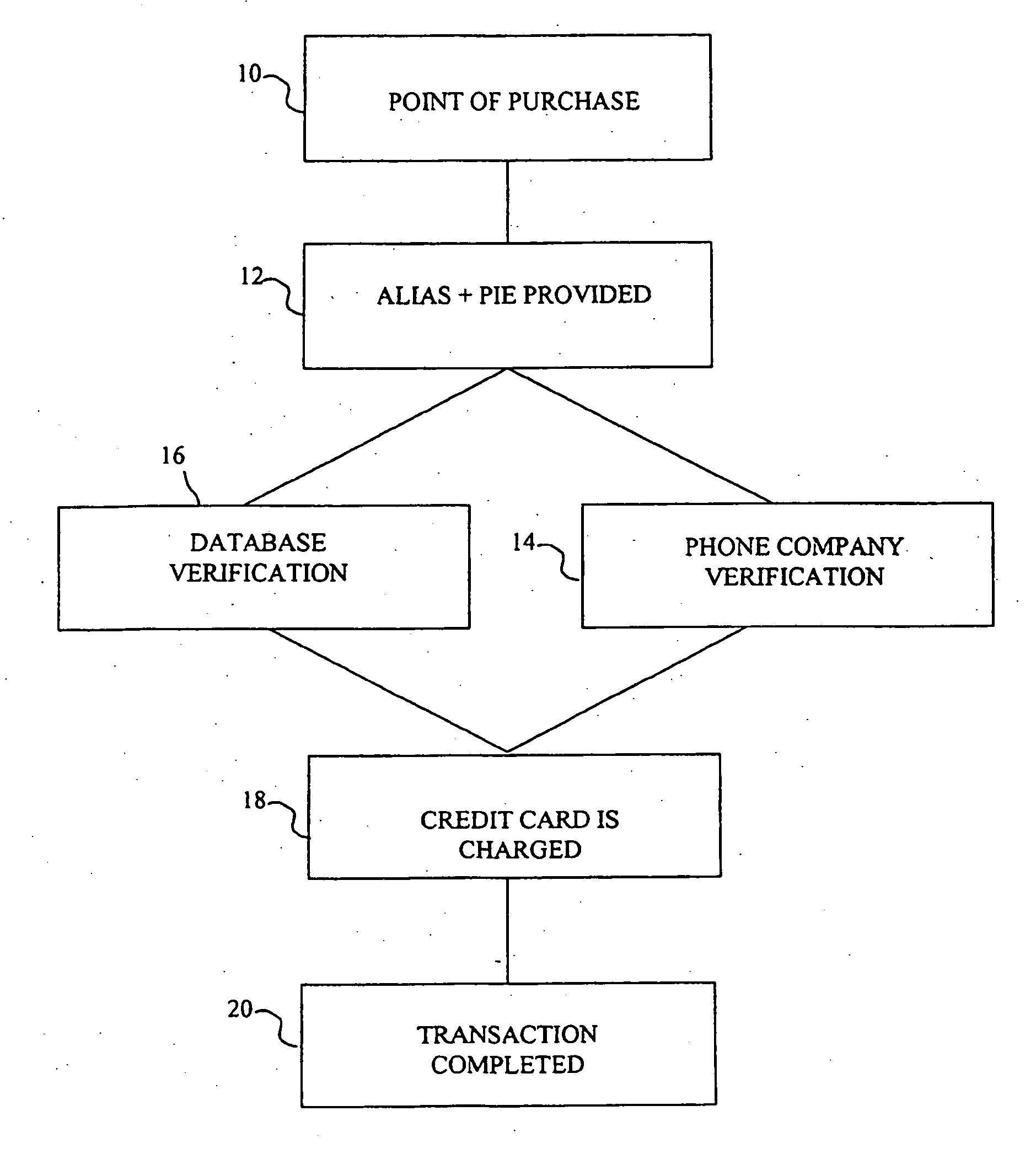

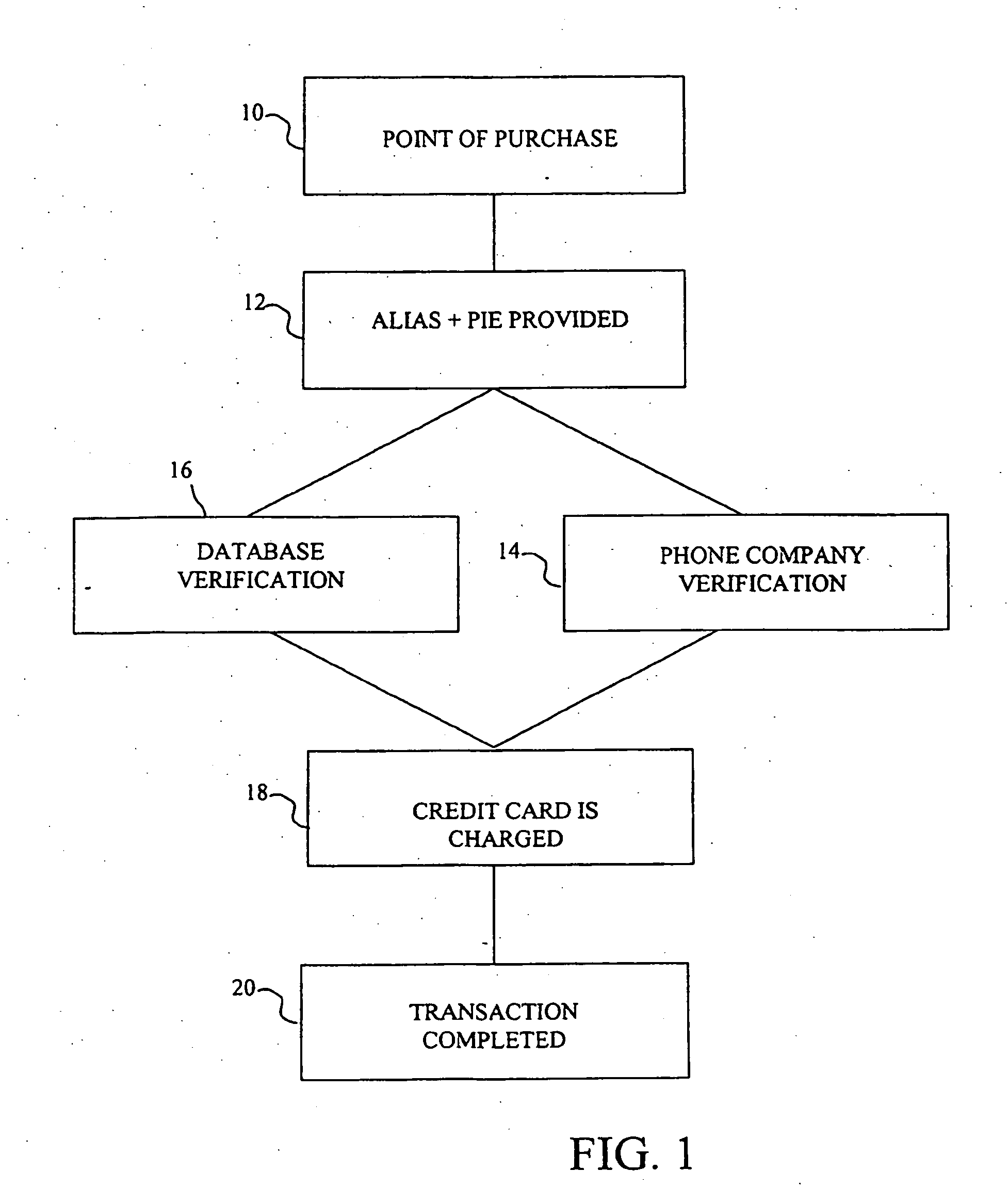

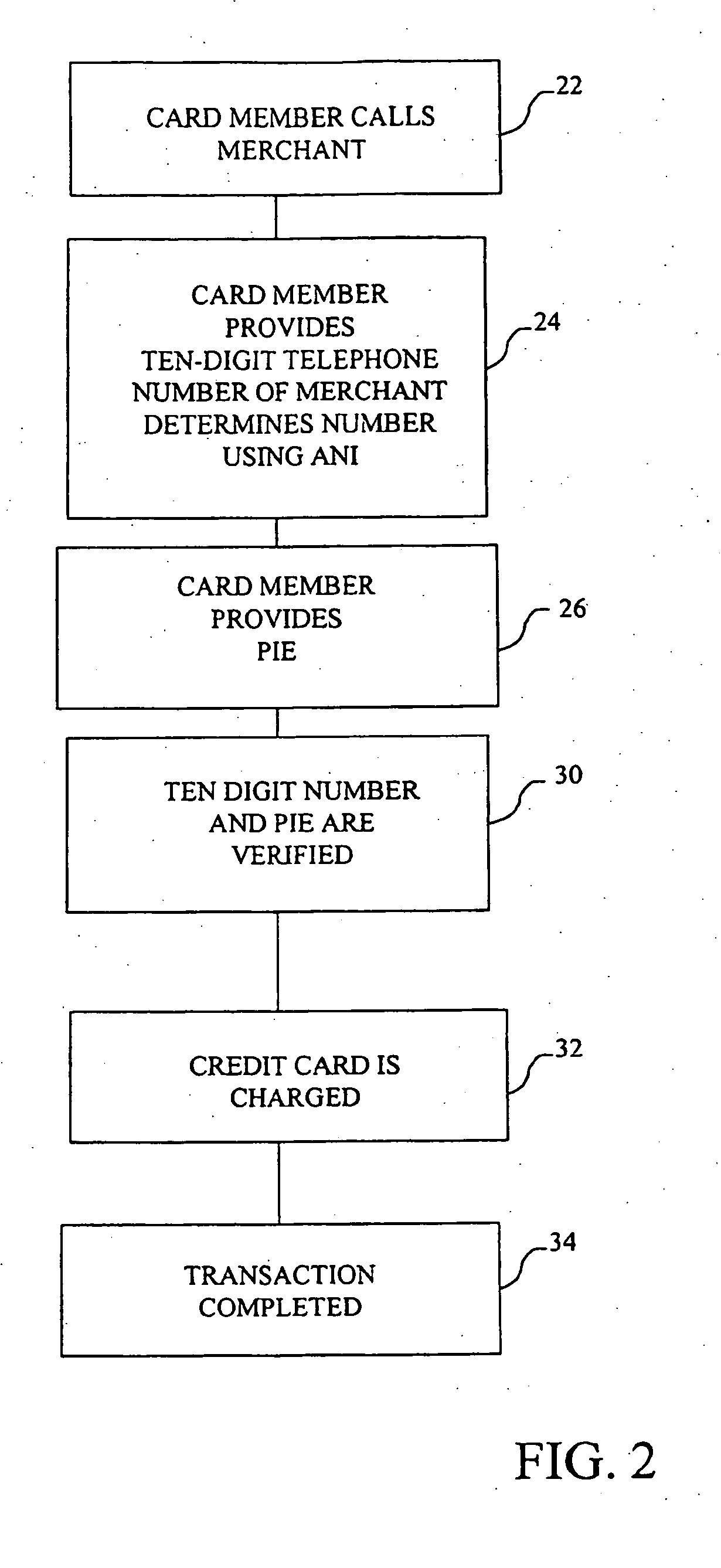

The method and system of the invention provide a variety of techniques for using a selected alias and a selected personal identification entry (PIE) in conjunction with use of a transaction card, such as a credit card, debit card or stored value card, for example. A suitable number or other identification parameter is selected by the account-holder as an alias. The account-holder is then required to choose a PIE for security purposes. The alias is linked to the account-holder's credit card number via a database. When the account-holder enters into a transaction with a merchant, the physical card need not be present. The account-holder simply provides his or her alias and then the PIE. This can be done at any point of sale such as a store, catalog telephone order, or over the Internet. The alias and PIE are entered and authorization is returned from the credit card company.

Owner:JPMORGAN CHASE BANK NA

Cashless payment system

InactiveUS20050015332A1Without any loss of transaction processing flexibilityWidespread acceptanceFinanceBuying/selling/leasing transactionsComputer networkEngineering

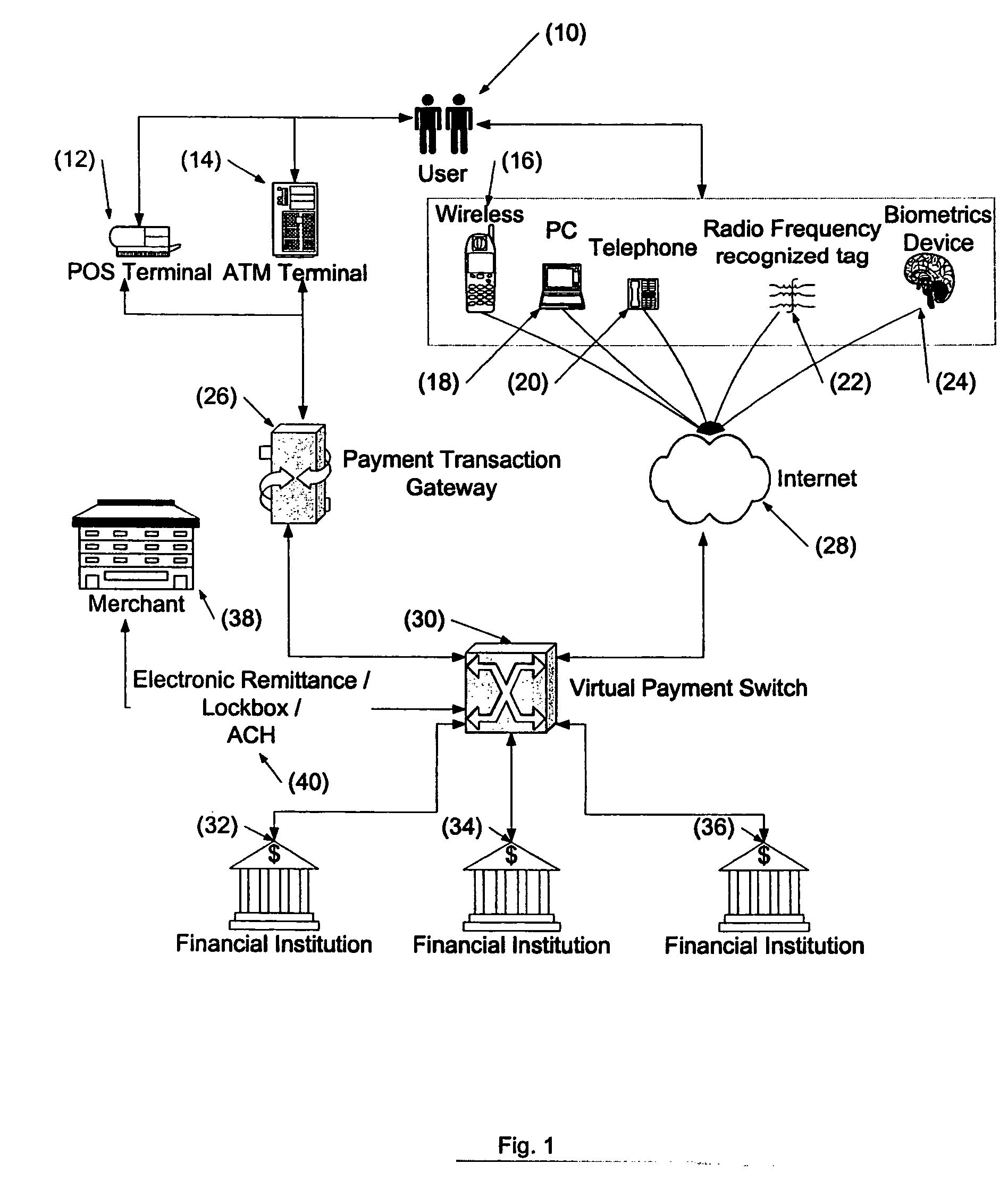

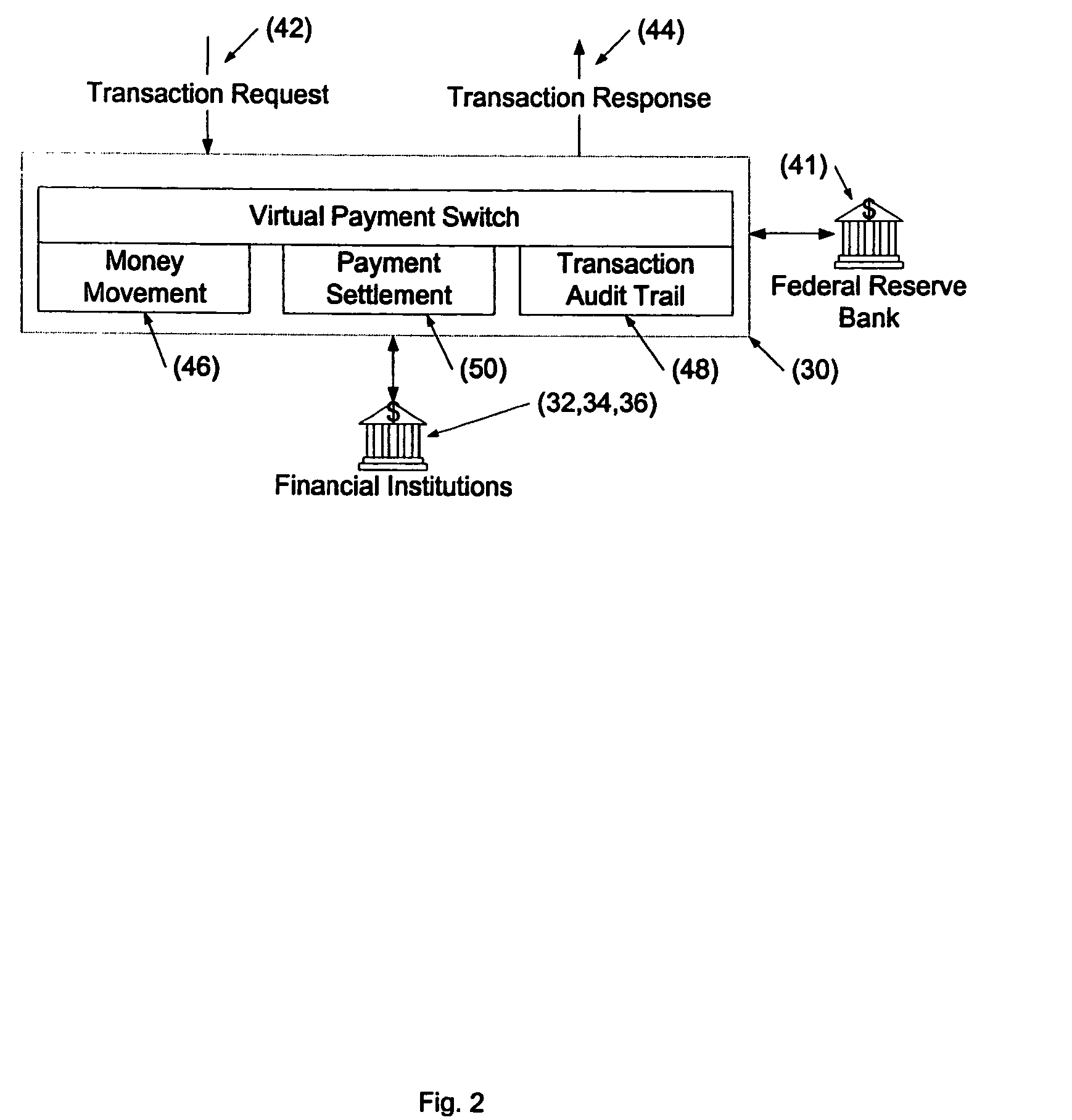

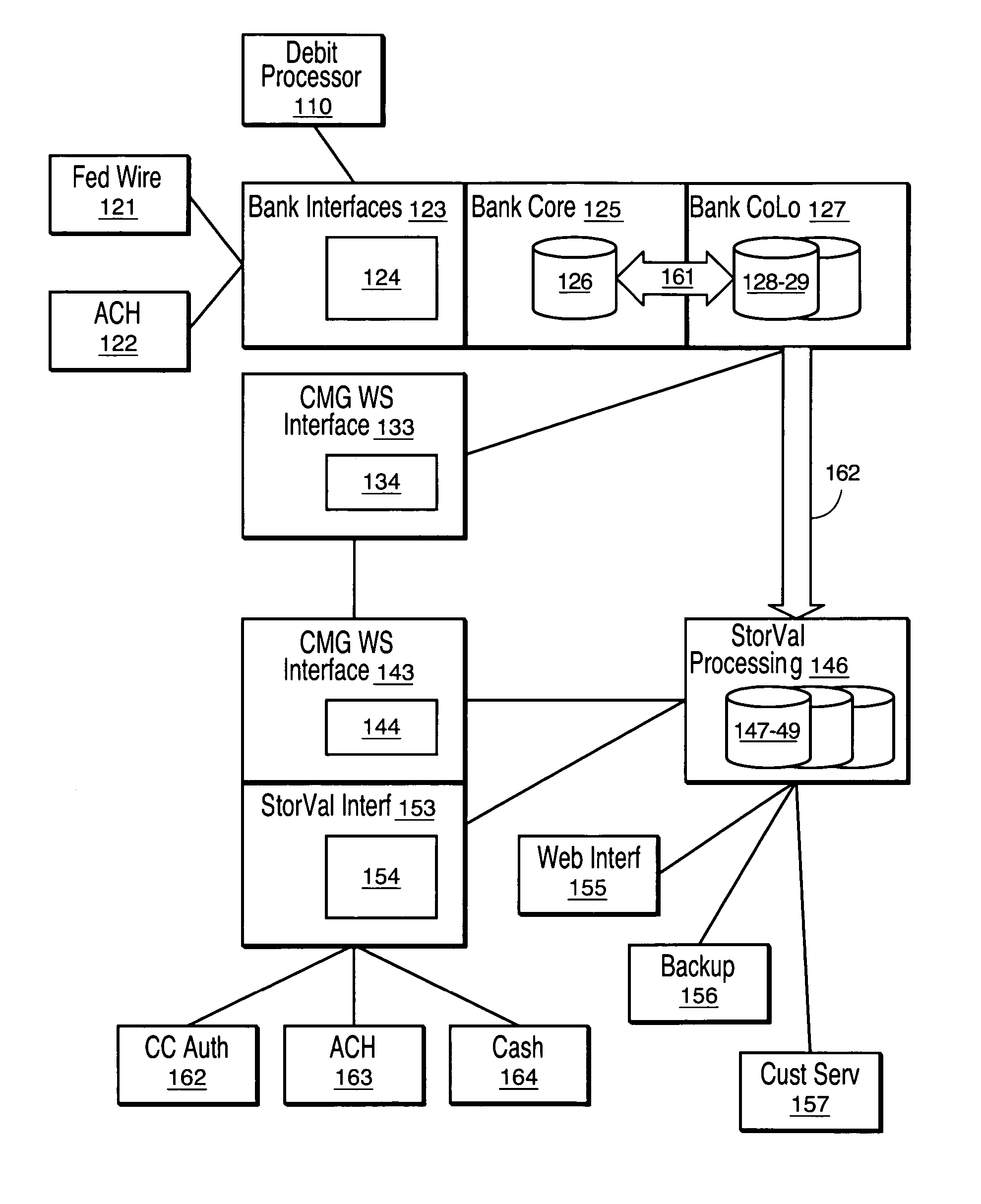

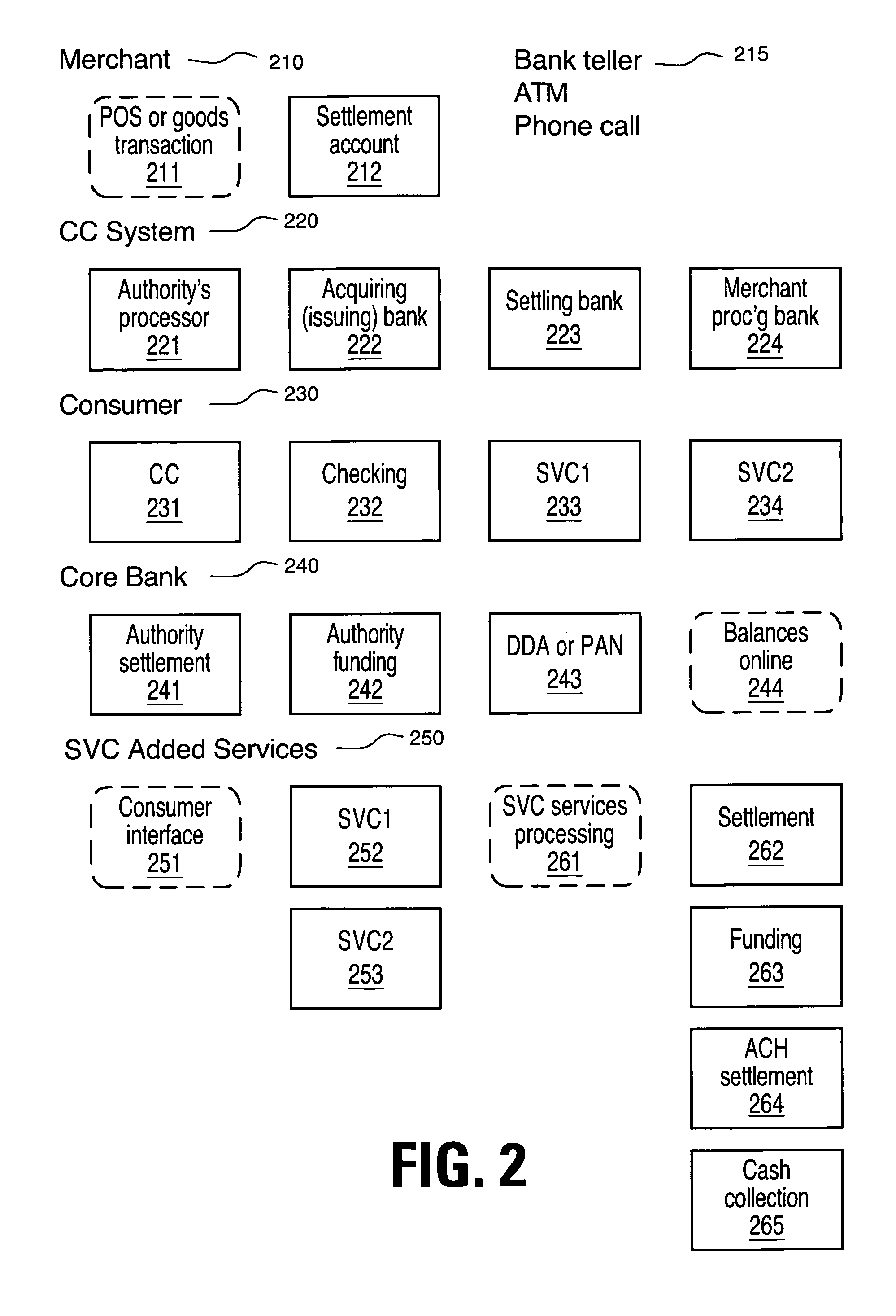

A payment system that does not rely on credit or debit cards, does not require the merchant and purchaser to have compatible memberships to complete a transaction, and does not limit single transactions to a single account provides a wide range of flexibility permitting debit, credit, pre-paid and payroll cards to be accommodated in a seamless and invisible manner to the electronic transaction network. The transaction may be verified and approved at the point-of-sale whether or not the merchant is a member of a specific financial transaction system. Specifically, the point-of-sale transaction system permits an identified customer to use any of a variety of payment options to complete the transaction without requiring the merchant to pre-approve the type of payment selected by the customer. In one configuration, and in order to take advantage of the widespread use of the ATM / POS network, the invention uses a typical credit / debit card format to provide the identifying information in a stored value card. When a transaction is to be completed, the user enters the identifying information carried on the card at the point-of-sale. This can be a merchant or other service provider at a retail establishment, or on-line while the user is logged onto a web site, or other location. The information can be swiped by a card reader, or manually entered via a keyboard or other input device. The system supports a wide range of flexibility, permitting issuing systems such as parents and state welfare agencies to restrict the types of authorized uses, and permitting users to access accounts in a prioritized manner. Further, the accepting merchant is not required to be a member because settlement with the merchant may be made via the Federal Reserve Automatic Clearing House (ACH) system by typical and standard electronic transfer. This permits the merchant to take advantage of the lower ACH transaction fees with even greater convenience and flexibility than the current ATM / POS system. The system supports numerous types of identification methods from typical credit card structures with magnetic data strips to various biometric systems such as finger prints, facial recognition and the like. Specifically, once the user is identified, the transaction is managed by his membership data on record with the transaction processing system.

Owner:ECOMMLINK

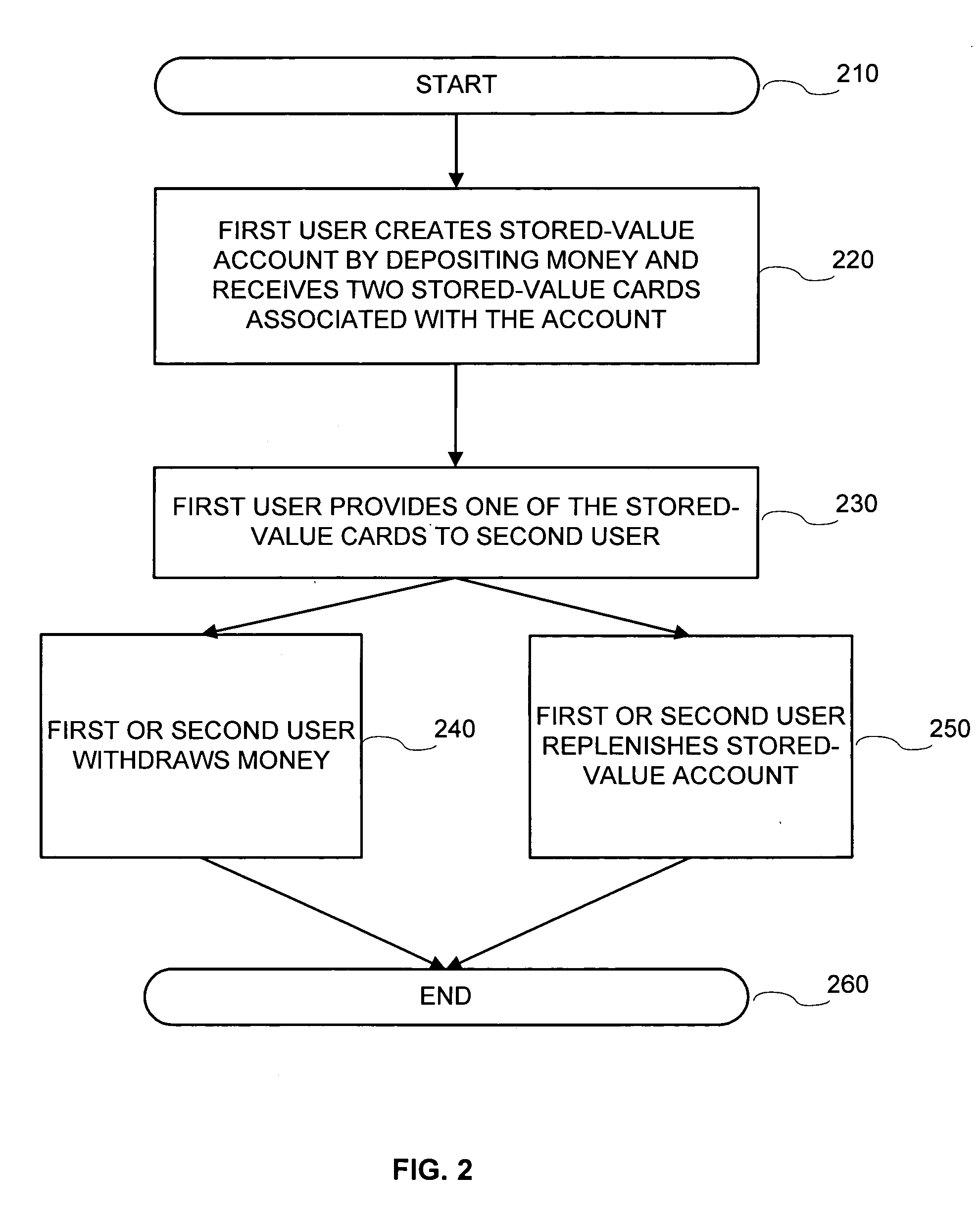

Systems and methods for money sharing

A system and a method for money sharing are provided. The system includes a processor configured to receive a deposit amount and assign an account value to a stored-value account. The stored-value account is stored in a storage device. The processor then dispenses two or more stored-value cards associated with the stored-value account. The stored-value cards can be distributed among two or more cardholders who may withdraw money from the stored-value account at a remote access unit configured to accept any of the distributed stored-value cards associated with the same account. Additional deposit amount can be received into the stored-value account from a cardholder of any distributed stored-value cards associated with the same account. The remote access unit can be unattended. The cards can be ATM-enabled.

Owner:MONEYGRAM PAYMENT SYST

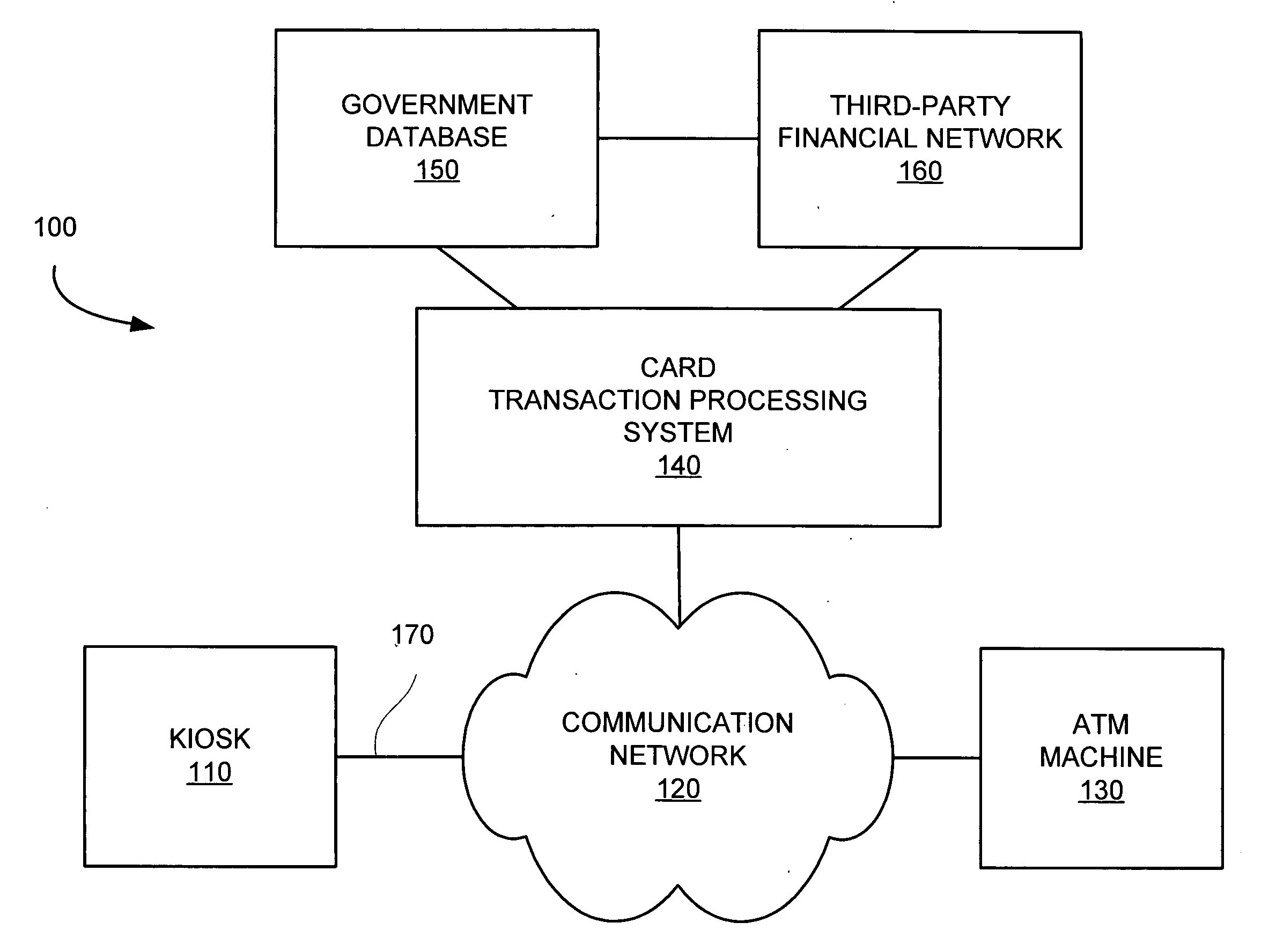

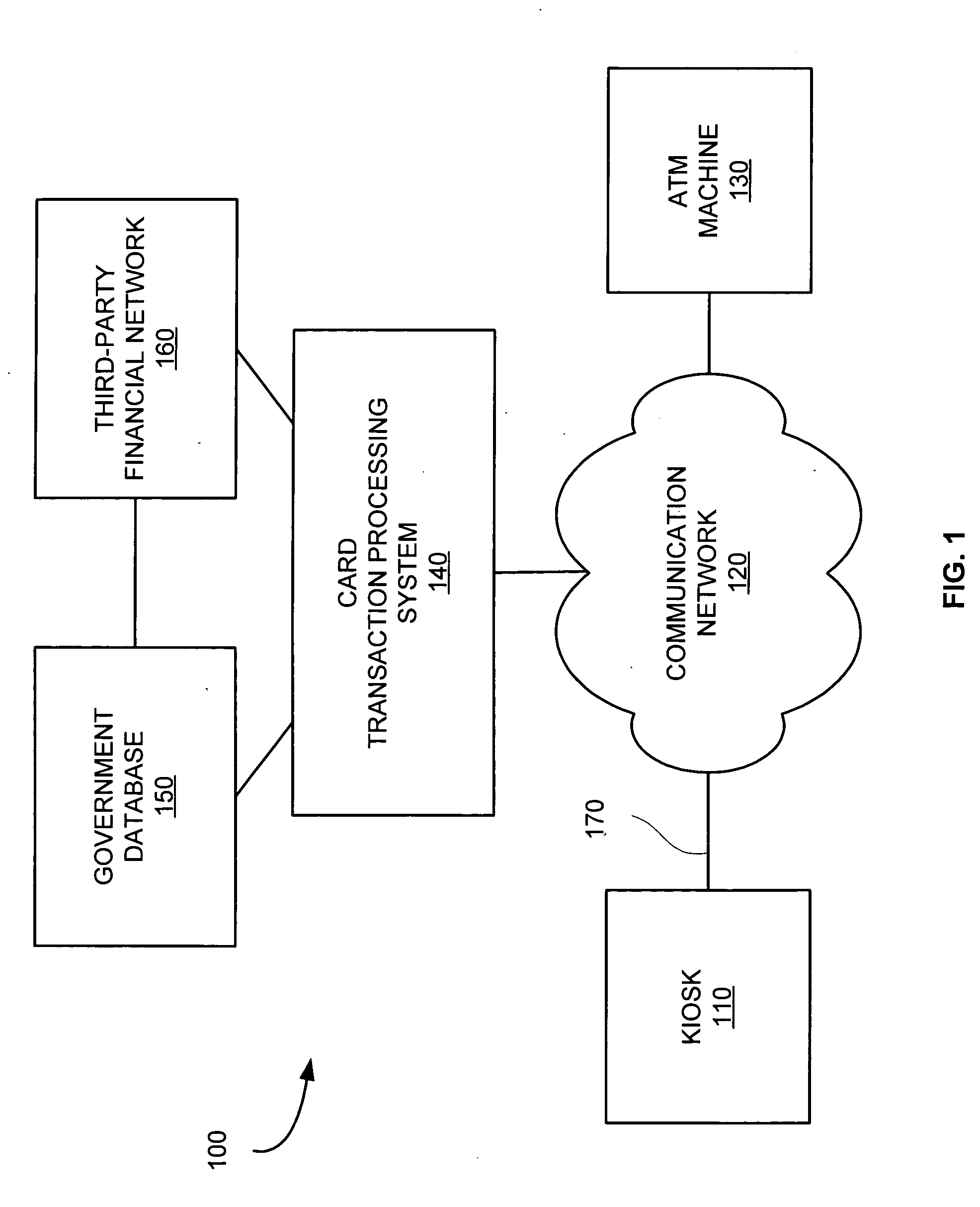

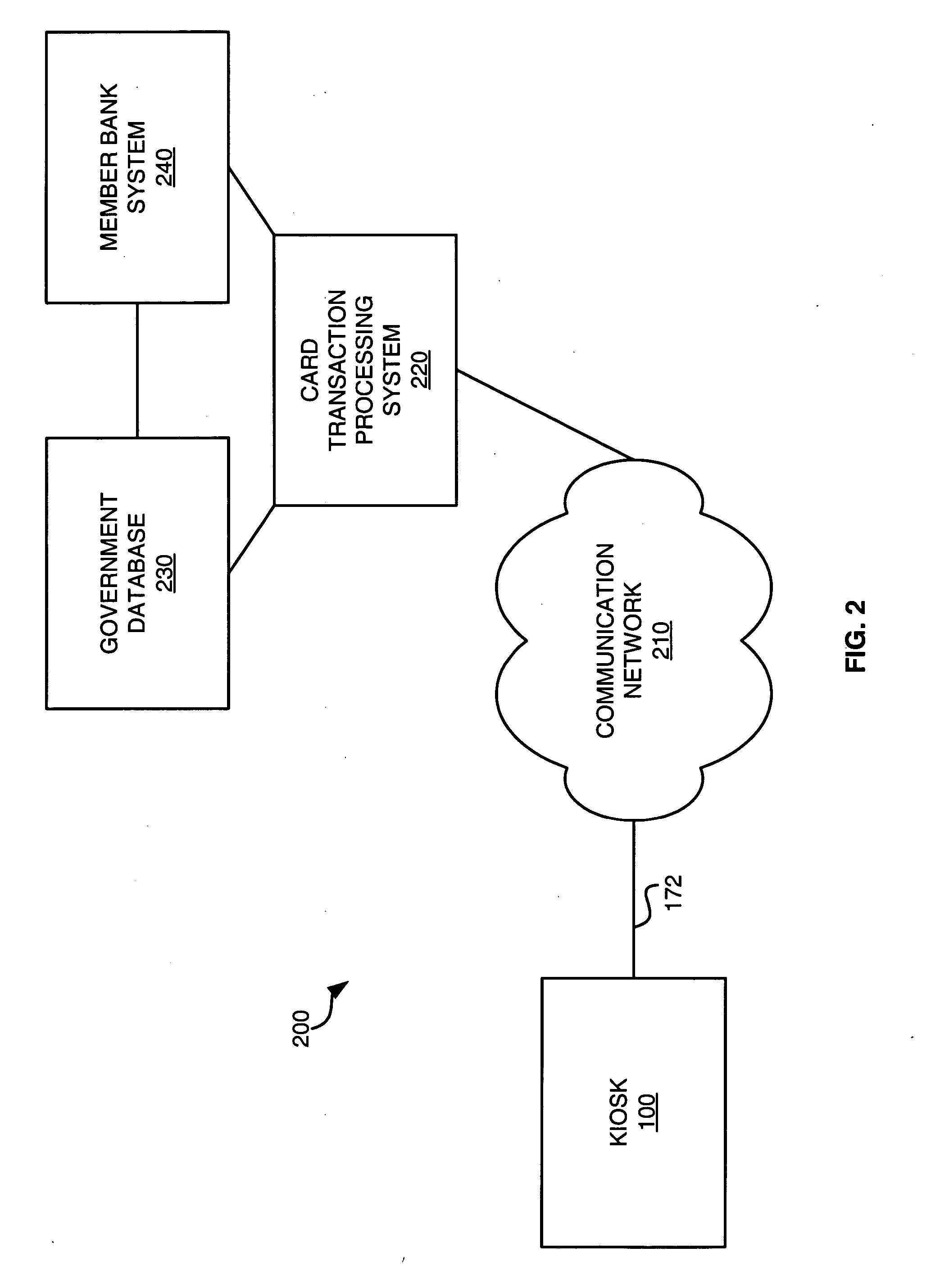

Systems and methods for banking transactions using a stored-value card

InactiveUS20050082364A1Conveniently performedProvide goodComplete banking machinesPre-payment schemesOperating systemStored-value card

Owner:NEXXO FINANCIAL

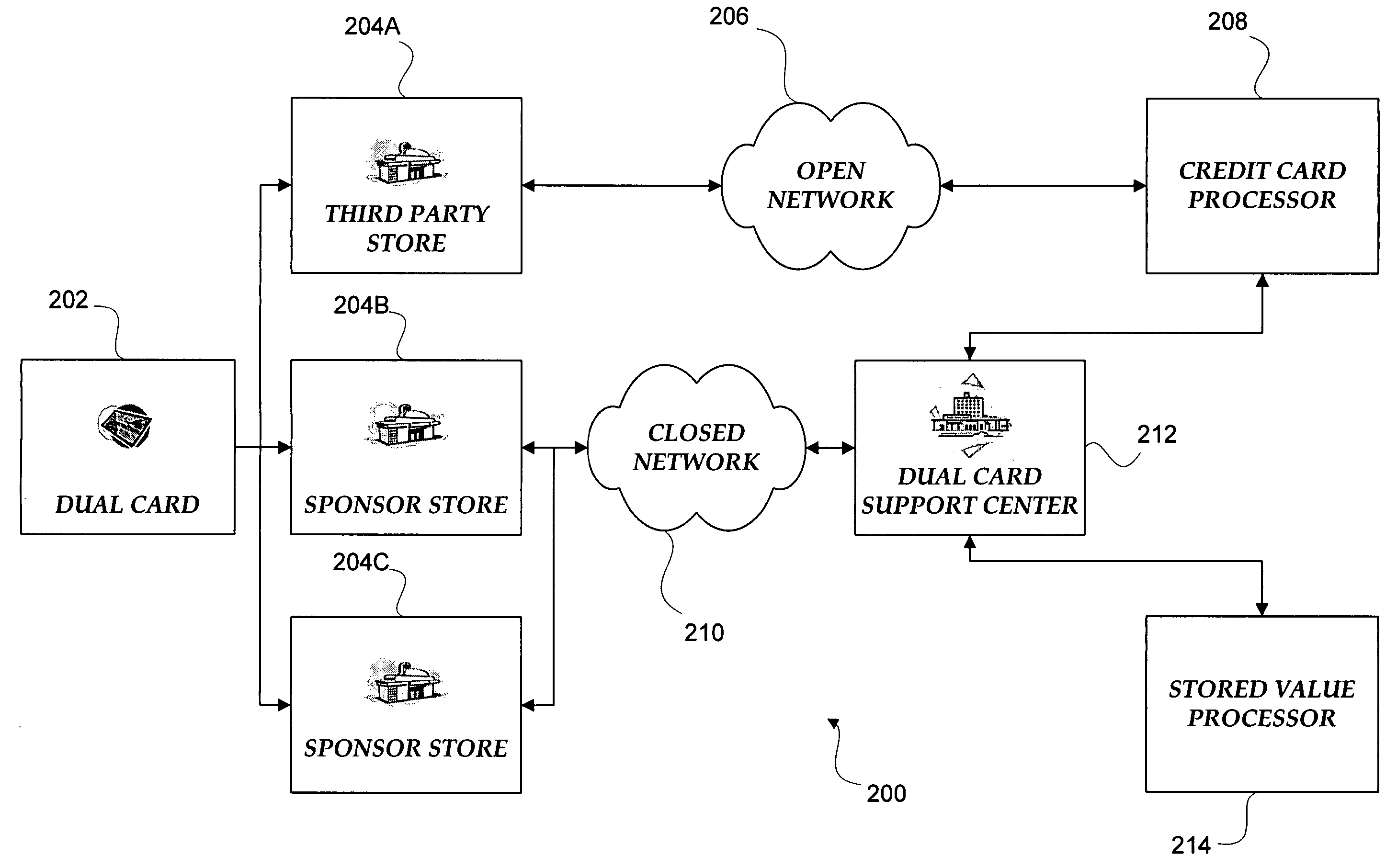

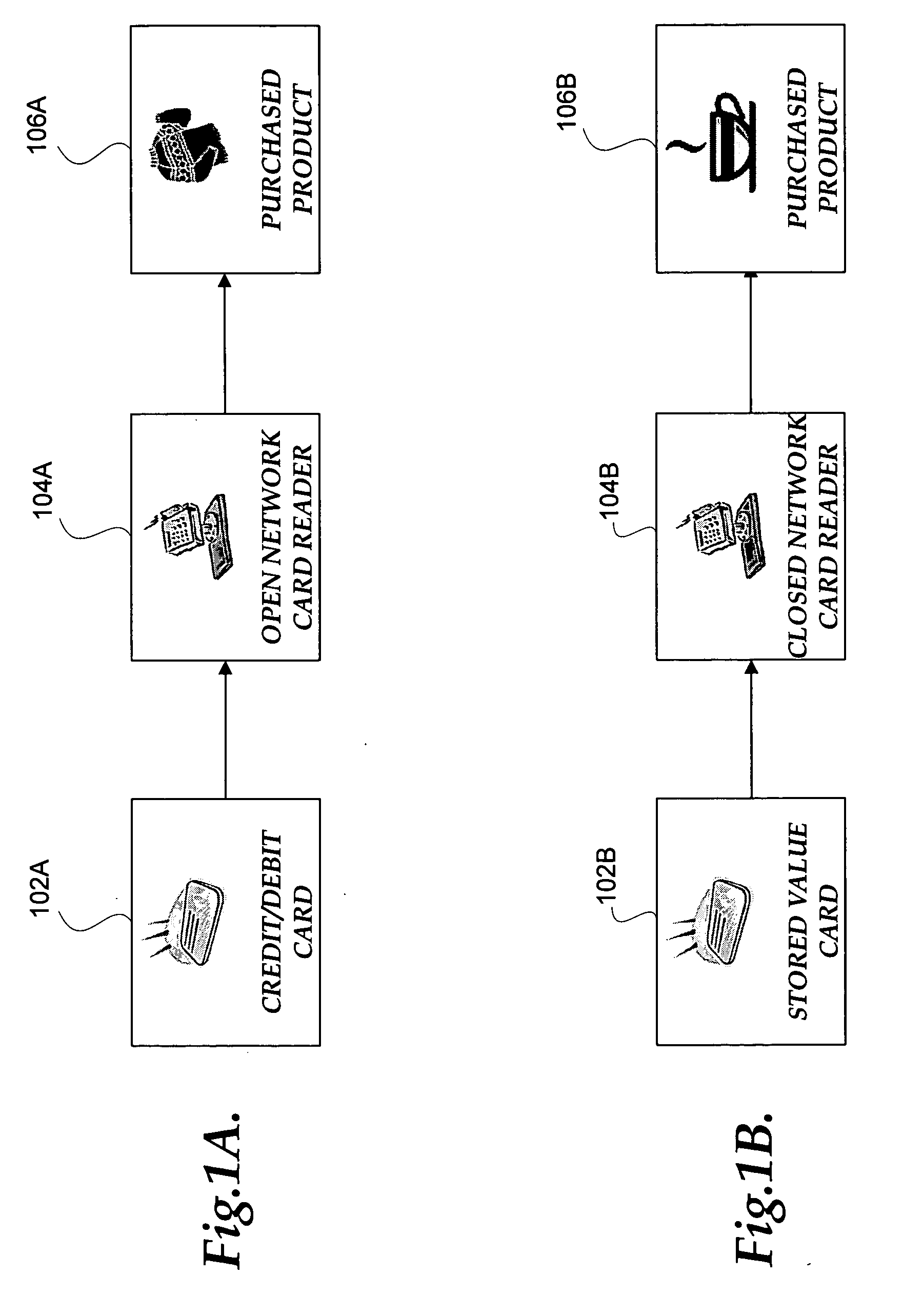

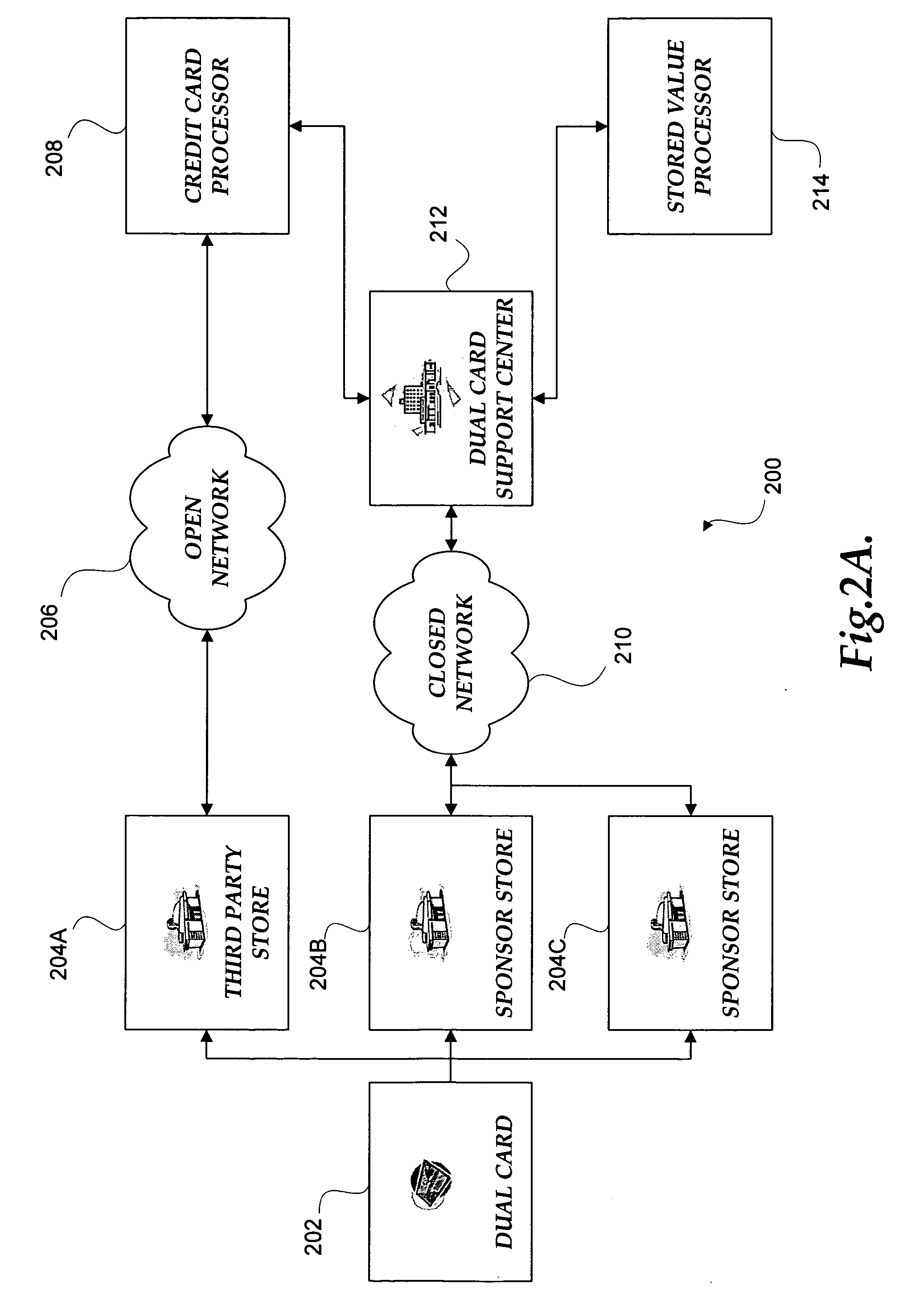

Dual card

A dual card, which facilitates payment for goods or services from either a credit account or a stored value account, operates on both an open network and a closed network. The dual card is a payment card that integrates the ability to provide credit privileges and stored value privileges to a cardholder of the dual card. The features, benefits, and advantages of a stored value card are integrated with the credit card aspects of the dual card. The benefits, features, and advantages of a credit card are integrated with a stored value card.

Owner:STARBUCKS +1

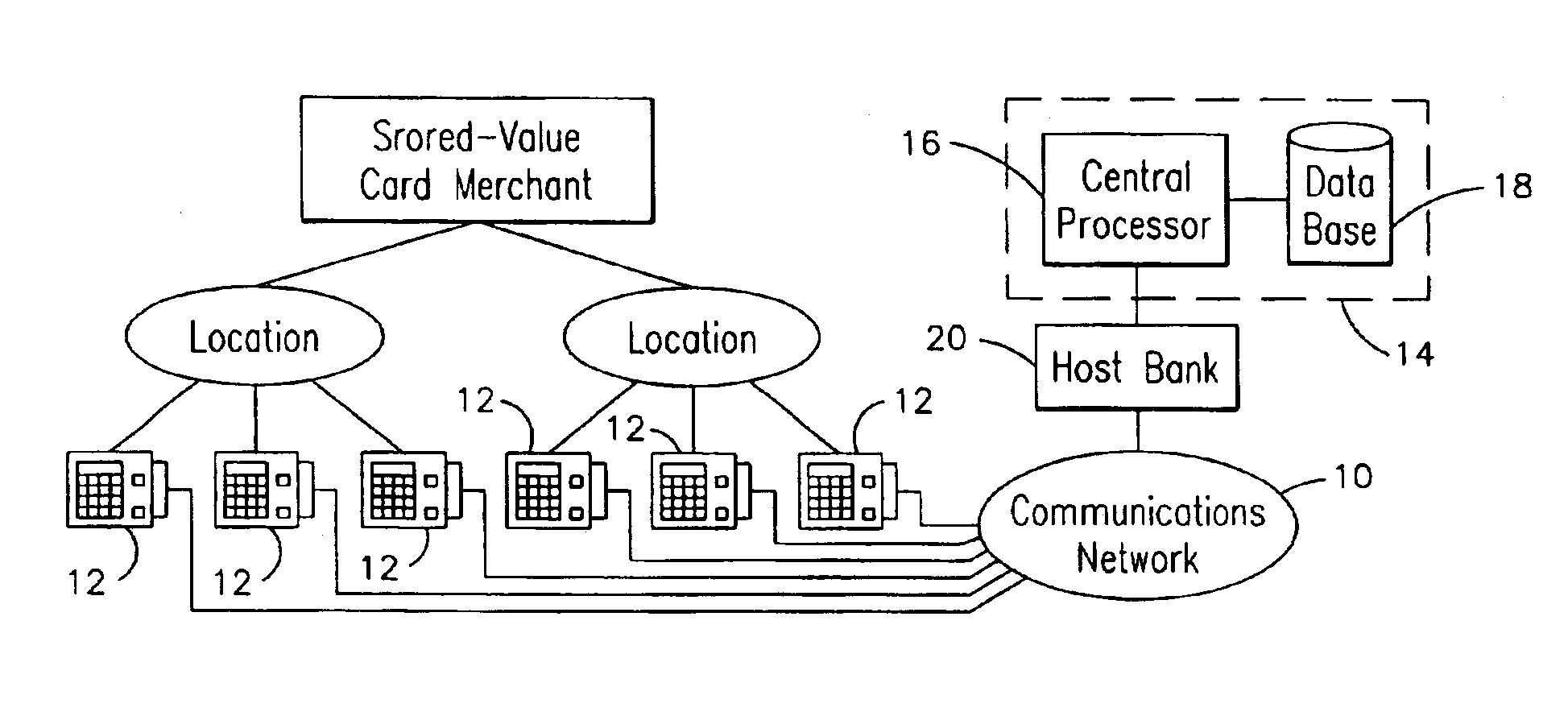

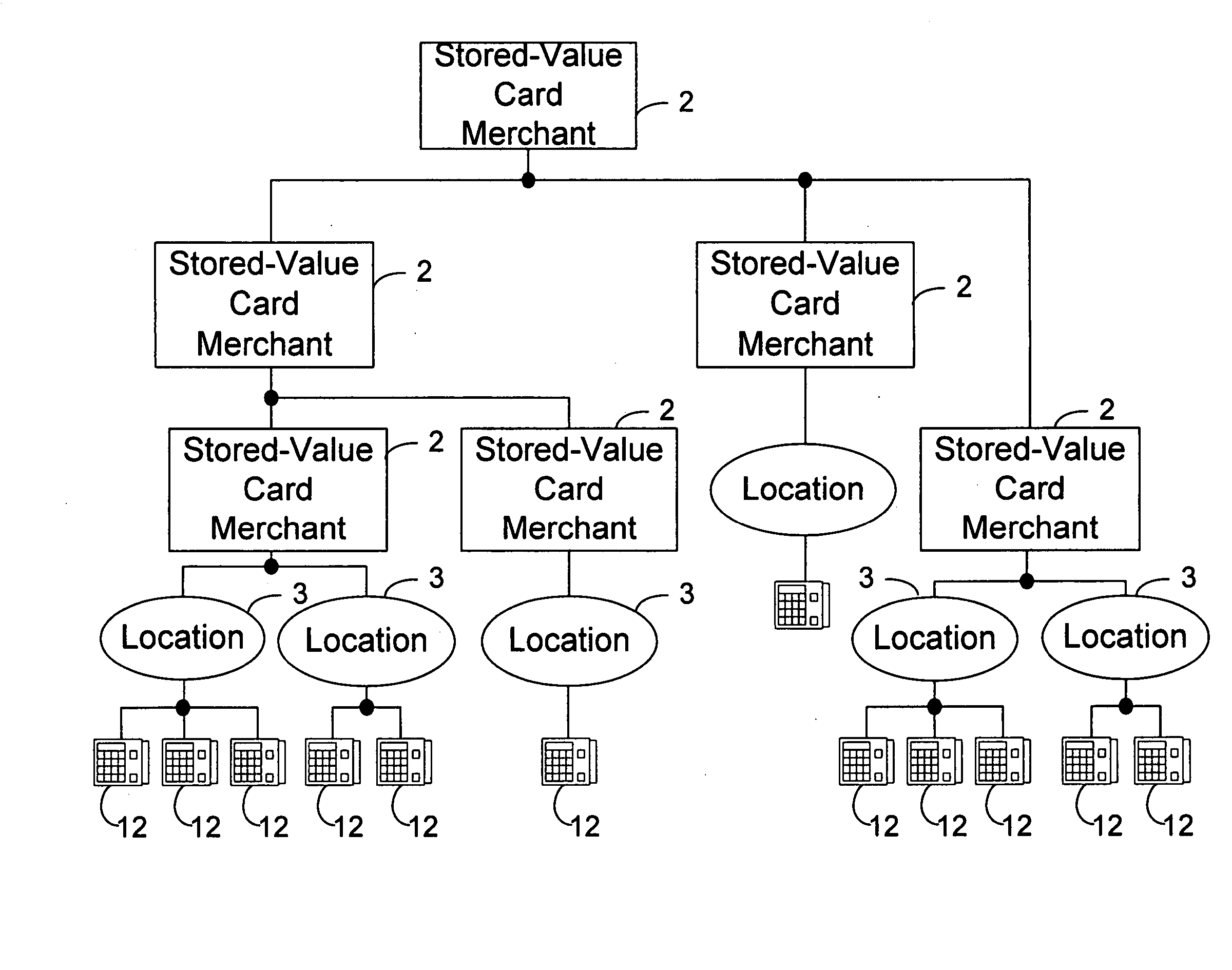

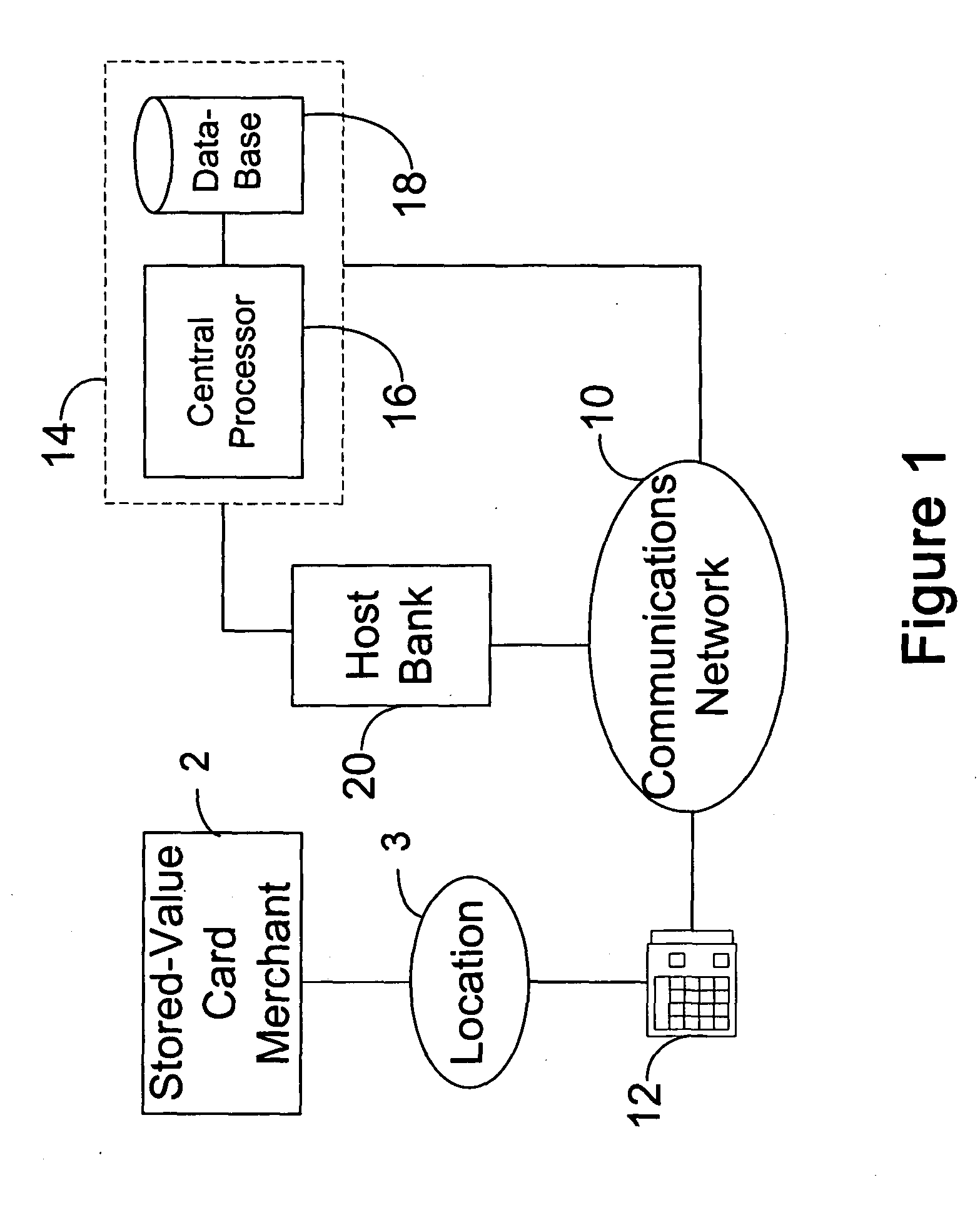

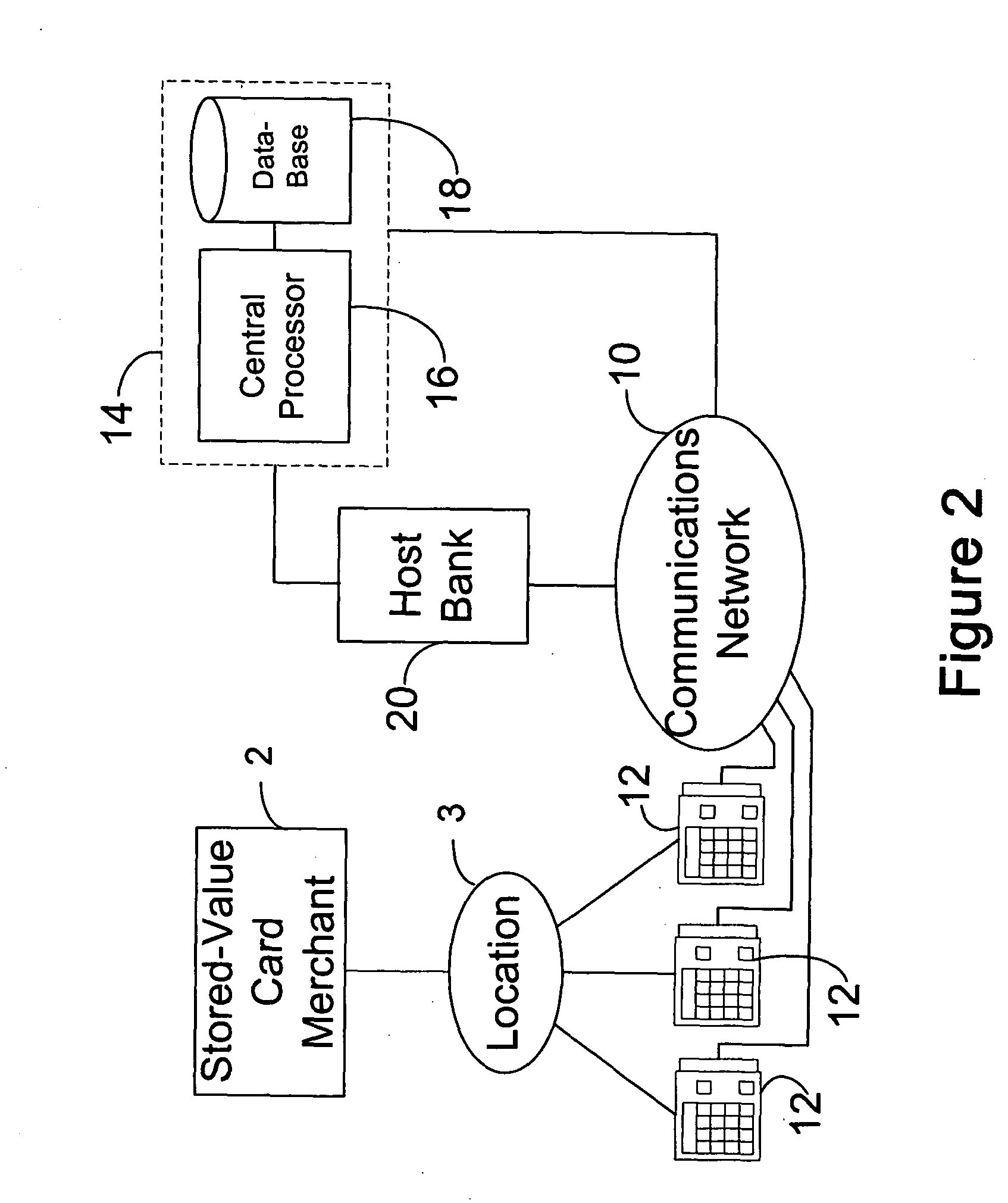

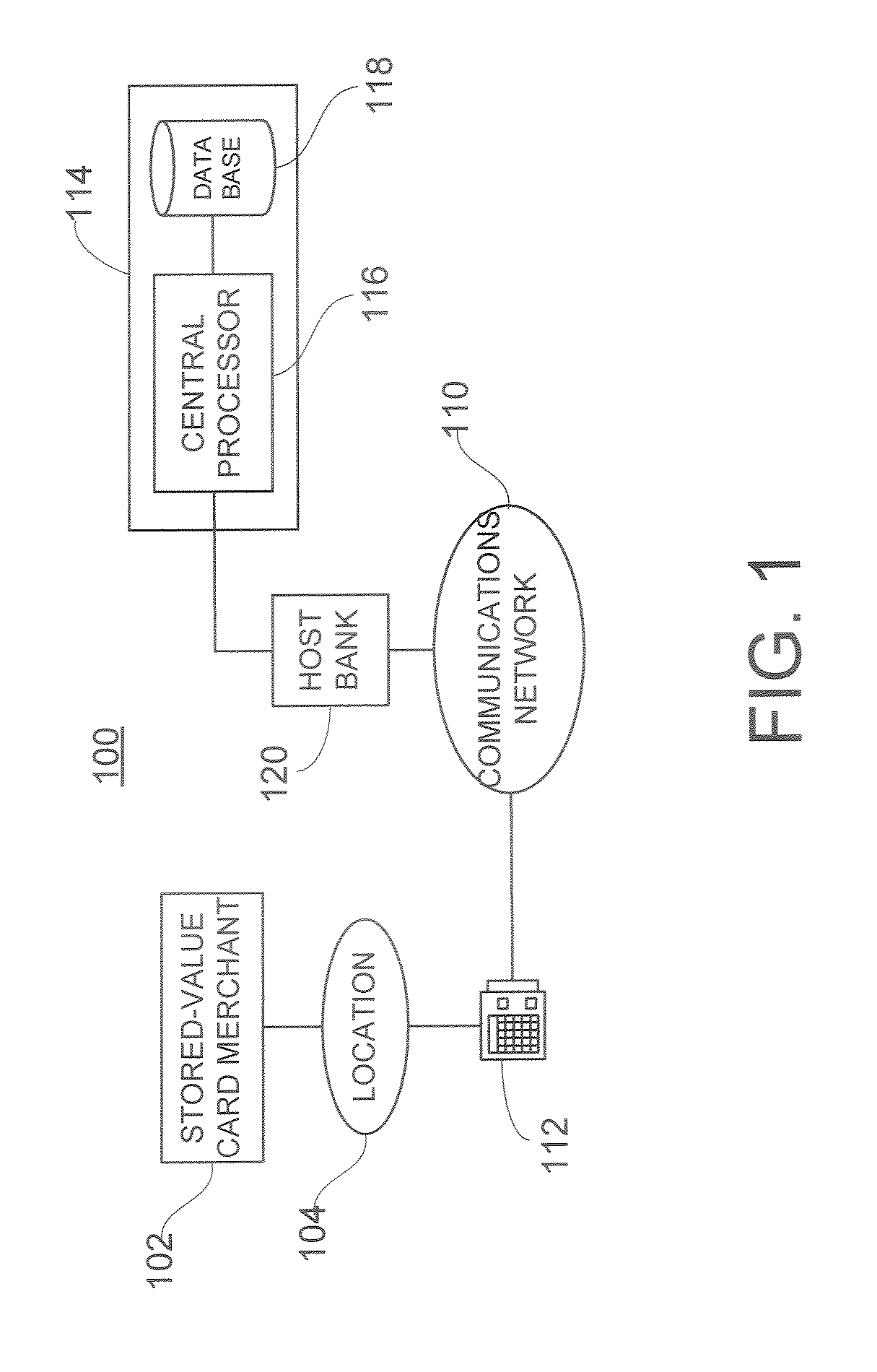

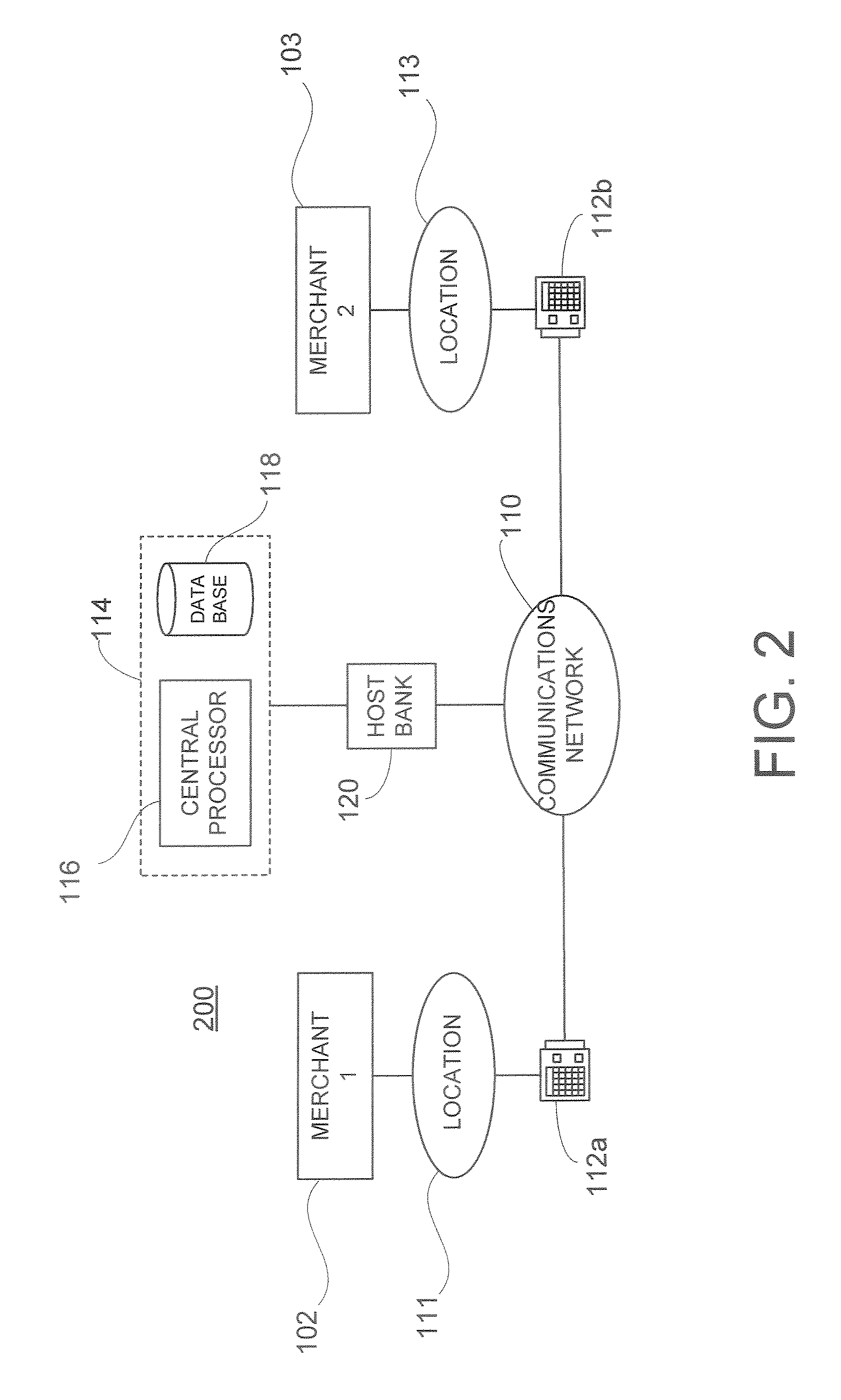

System and method for managing stored-value card data

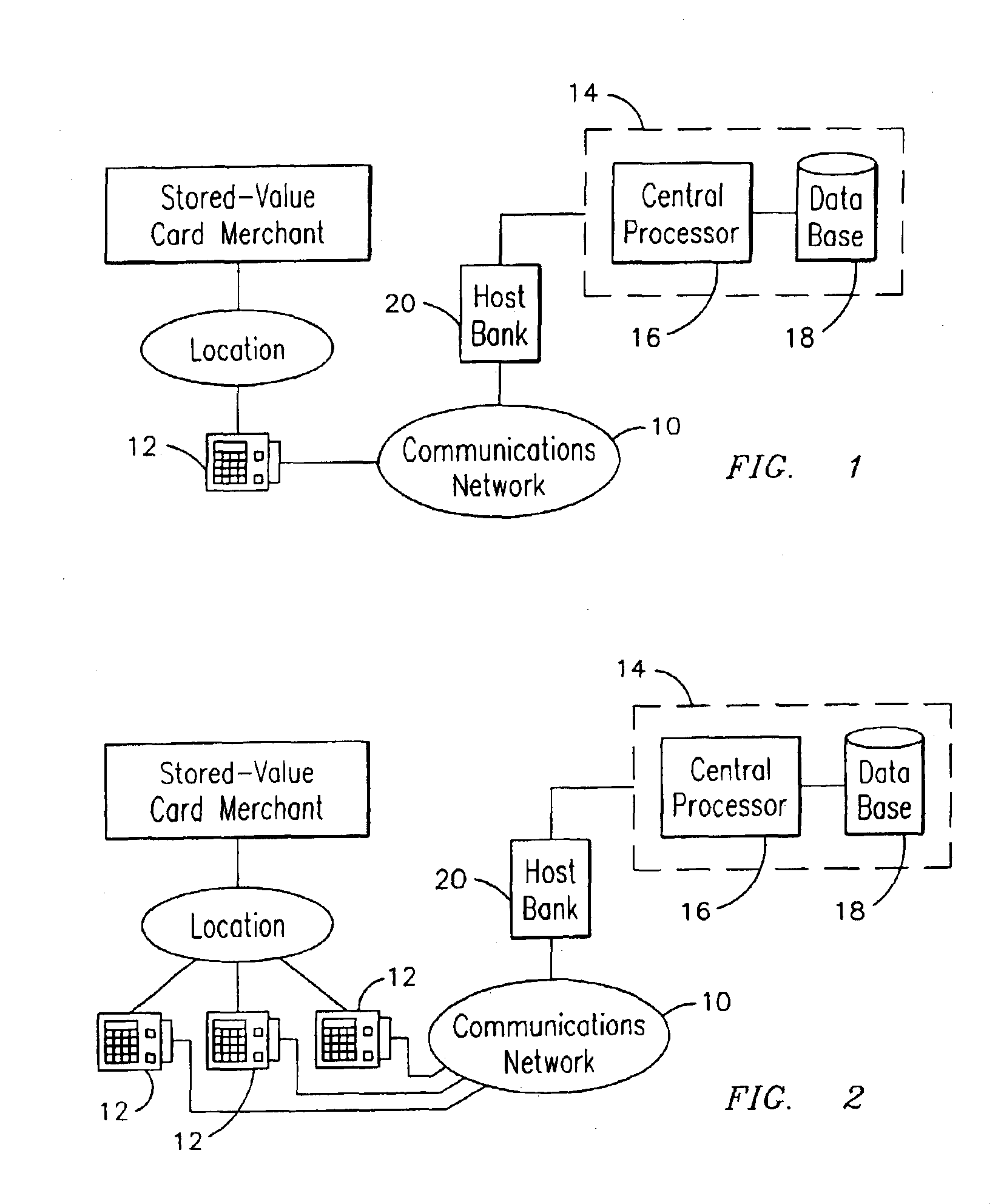

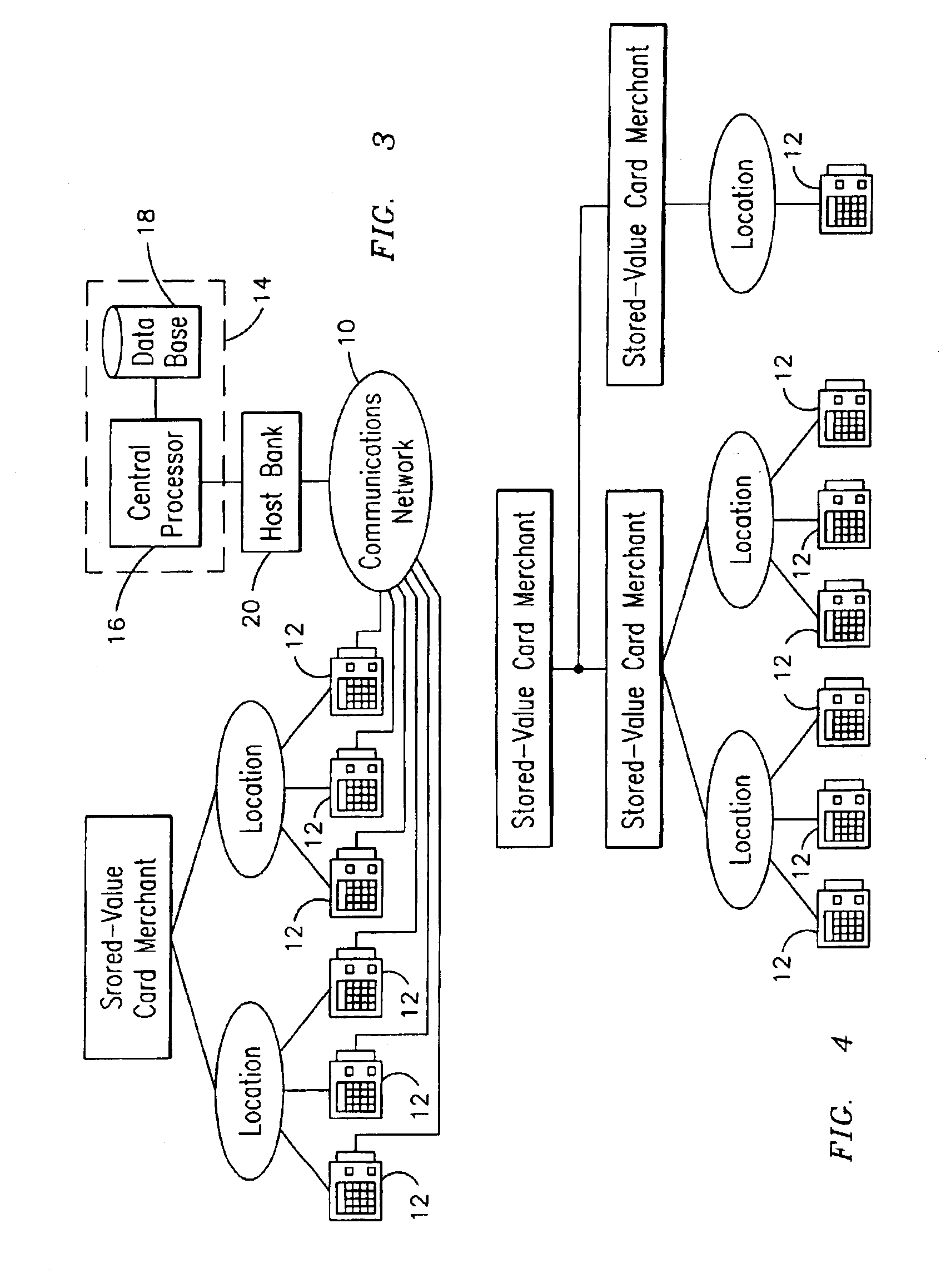

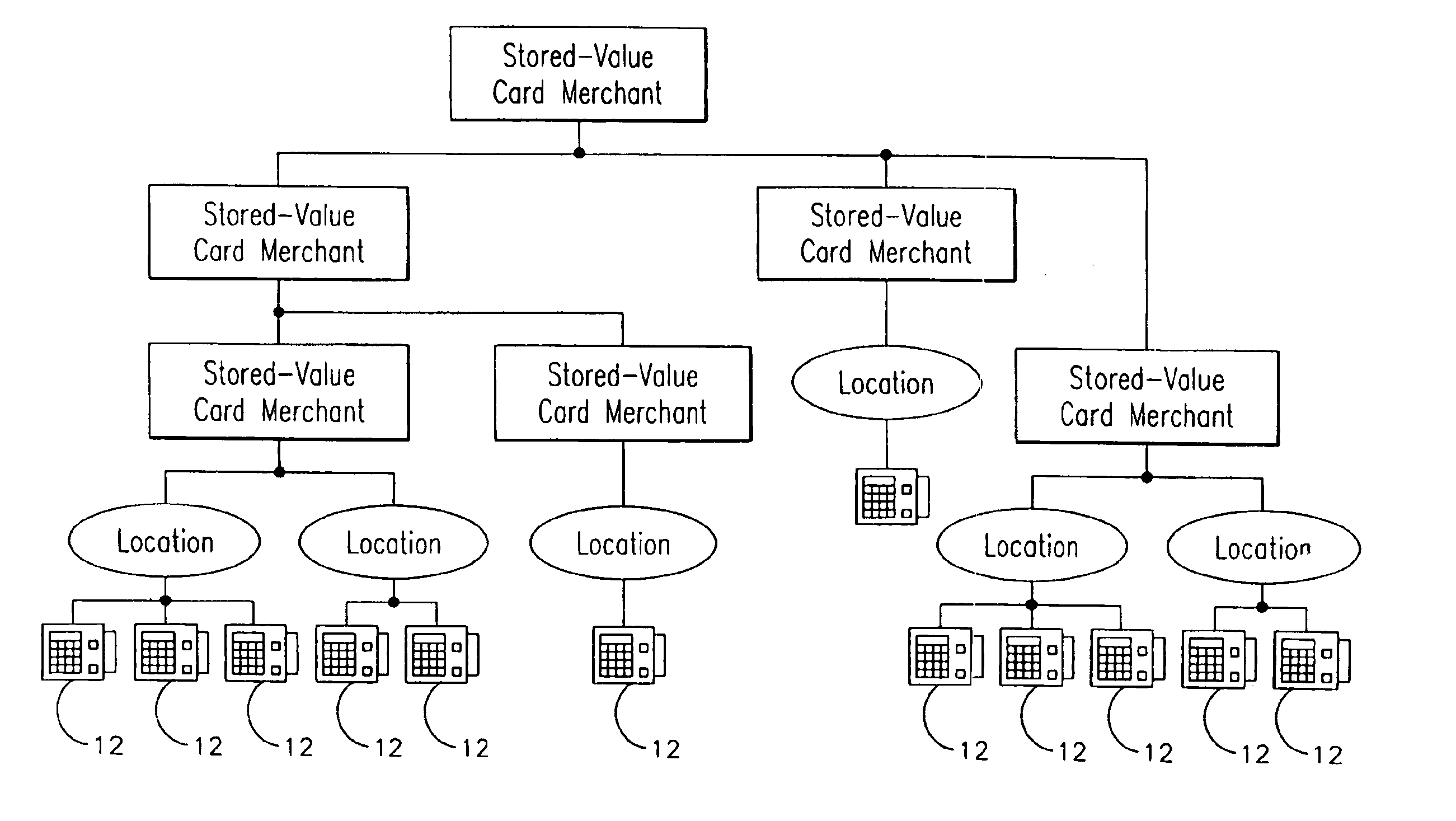

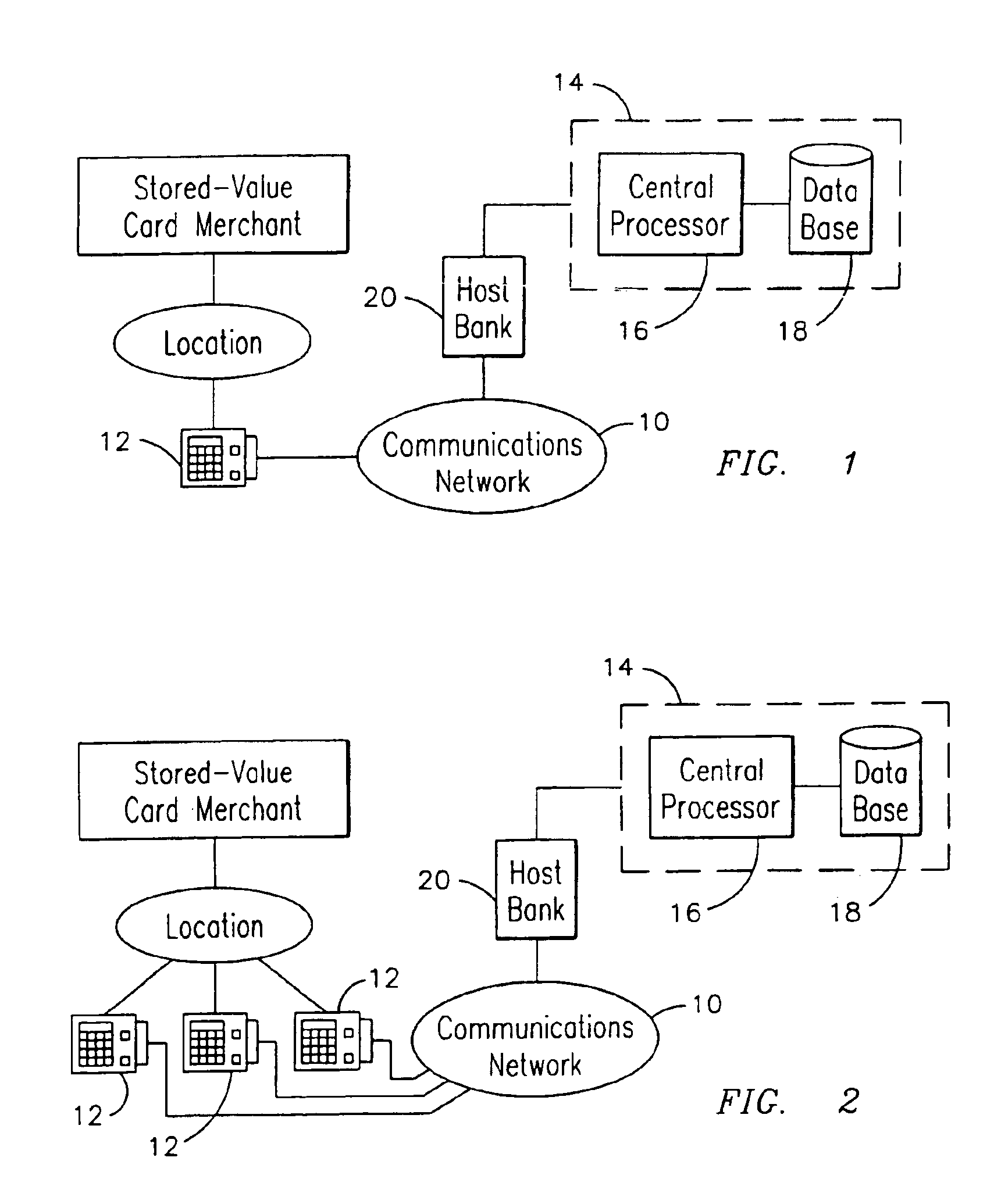

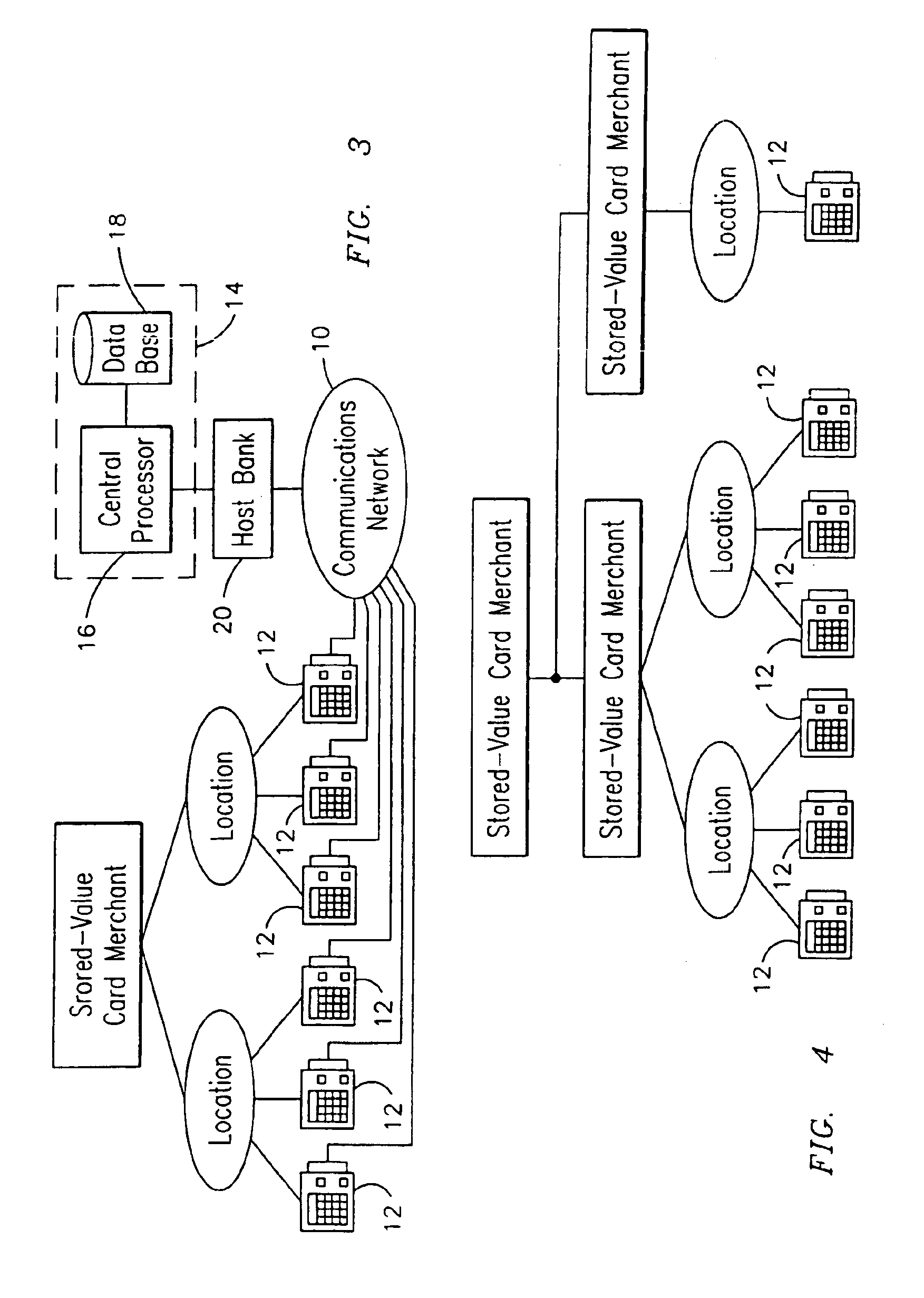

A computerized system and method for managing stored-value card data over a communications network between a plurality of terminals and a central processor is provided. Each of the terminals is accessible to respective users and is located in a respective location generally remote relative to the central processor. The stored-value card data is configured to securely process in real time stored-value cards transacted by respective users to enable charging prepaid stored-value services to a recipient of the transacted stored-value card. The method allows for providing a database coupled to the central processor. The method further allows for storing in the database a plurality of records comprising stored-value card data for each stored-value card. An associating step allows for associating in each stored record respective identifiers to uniquely match a respective stored-value card and a respective terminal. The associating step is enabled by assigning a “setup” card to the location and capturing the terminal information when a transaction utilizing that card is made. A transmitting step allows for transmitting a request of stored-value card activation to the central processor from a respective requesting terminal, the central processor configured to accept said activation request based on whether the associated identifiers for the stored-value card to be activated match identifiers actually transmitted by the requesting terminal for that stored-value card and terminal.

Owner:E2INTERACTIVE INC D B A E2INTERACTIVE

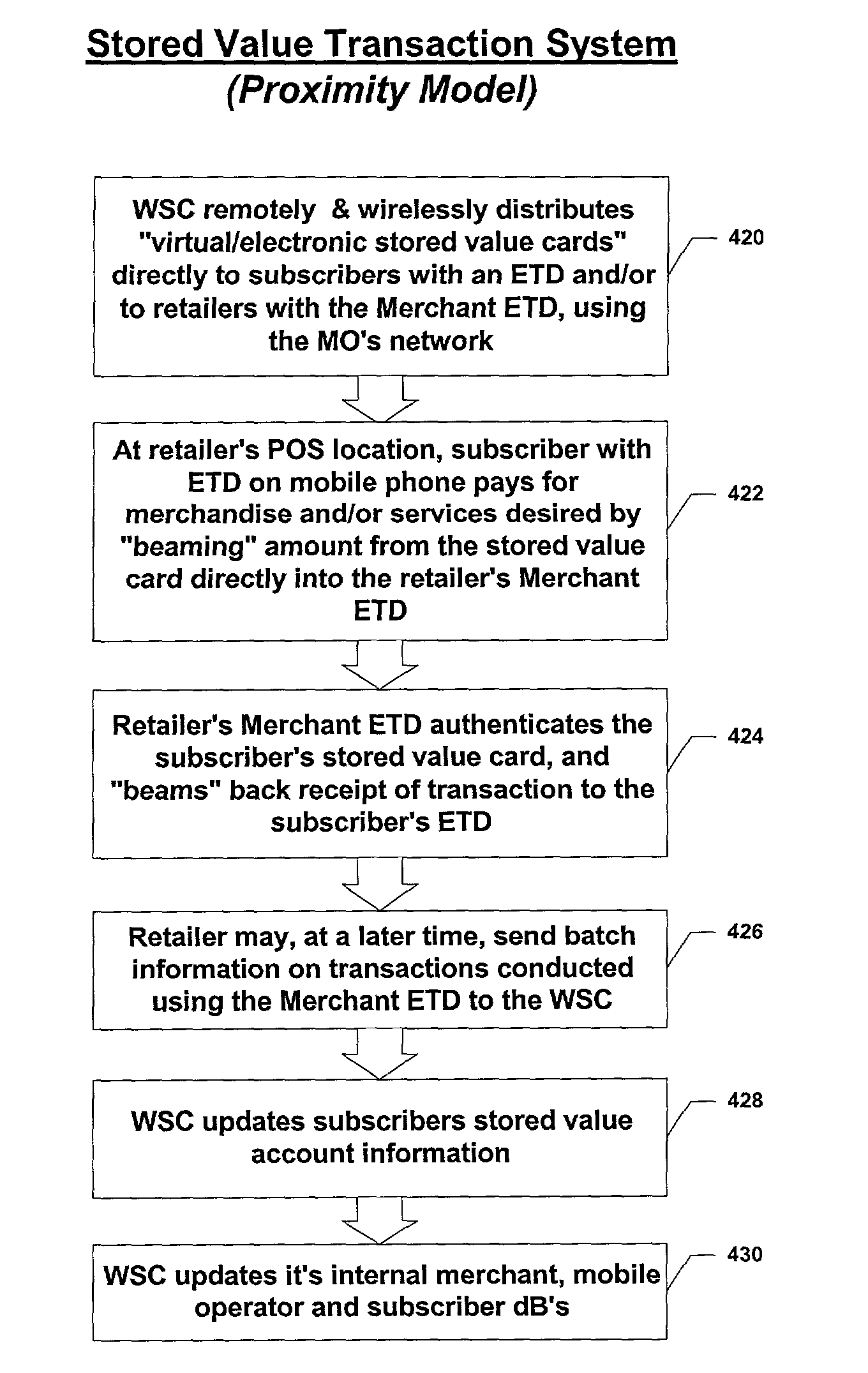

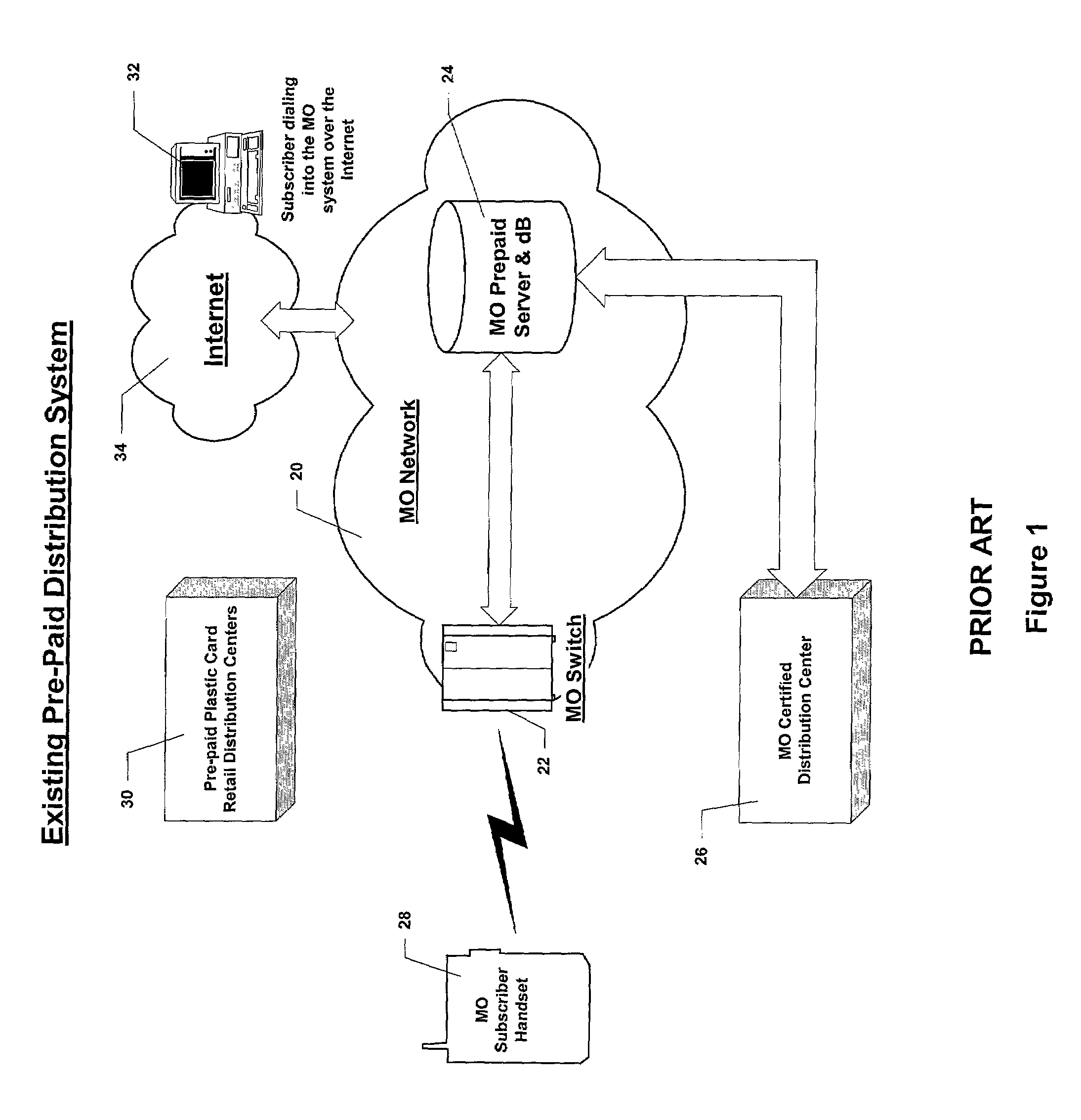

System for distribution and use of virtual stored value cards

InactiveUS7529563B1Acutation objectsUnauthorised/fraudulent call preventionTelephone cardStored-value card

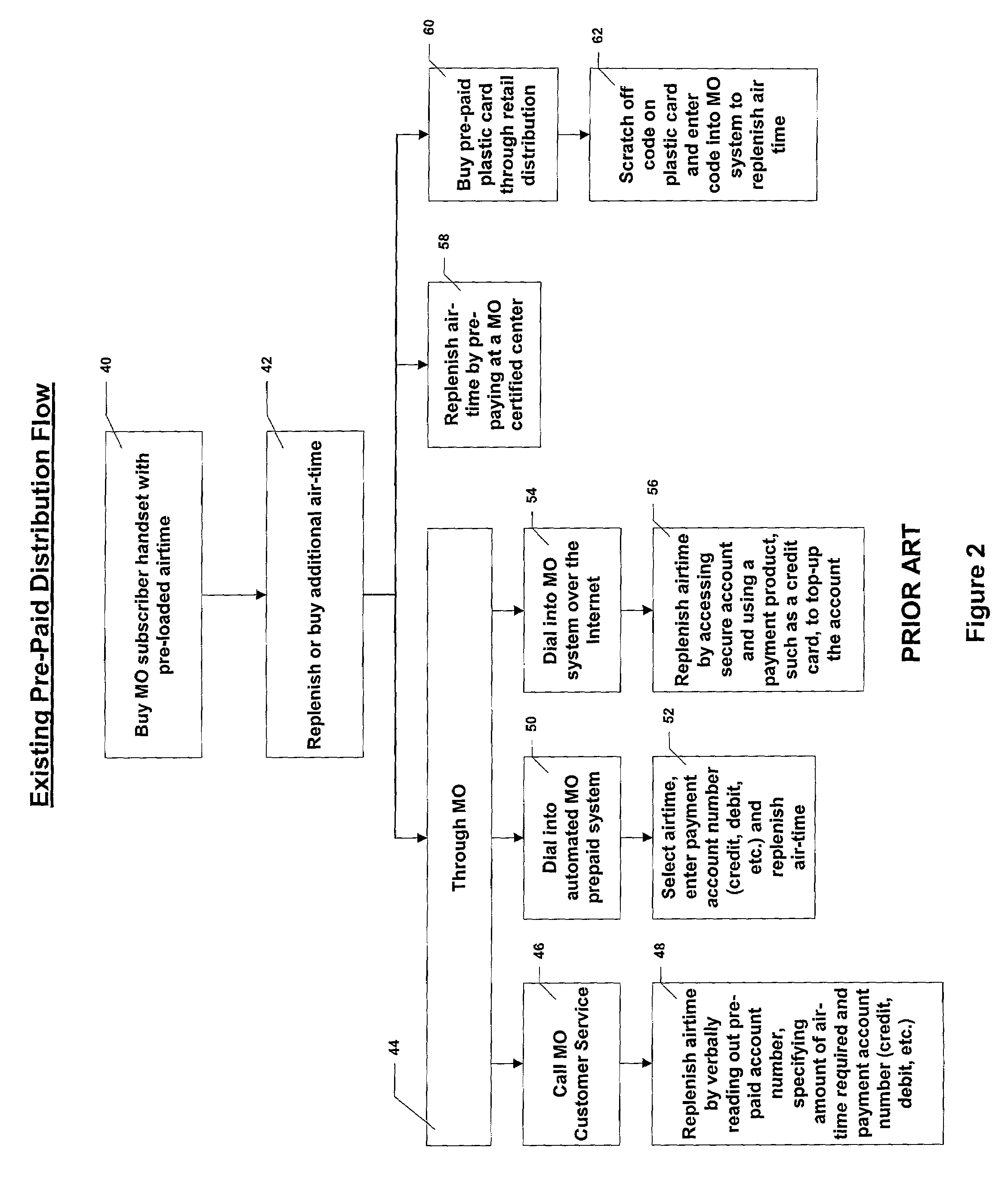

A method of exchanging payment information in an electronic transaction includes a first electronic transaction device transferring payment information to a second electronic transaction device, the second electronic transaction device transferring value information to the first electronic transaction device, and the second electronic transaction device transferring value information and payment information to a service consolidation center. A retailer electronic transaction device may transfer a virtual stored value card to a customer's electronic transaction device.A method of tracking retail sales of pre-paid telephone cards to cash subscribers includes entering value purchased information and subscriber information in a retailer electronic transaction device, the retailer electronic transaction device transferring the value purchased information and subscriber information to a mobile operator, and the mobile operator adding value corresponding to the value purchased information to an account corresponding to the subscriber information.

Owner:MASTERCARD MOBILE TRANSACTIONS SOLUTIONS

Systems and methods for authentication of a virtual stored value card

InactiveUS20100063906A1Improve securityAvoid lossComplete banking machinesFinanceComputer hardwareService provision

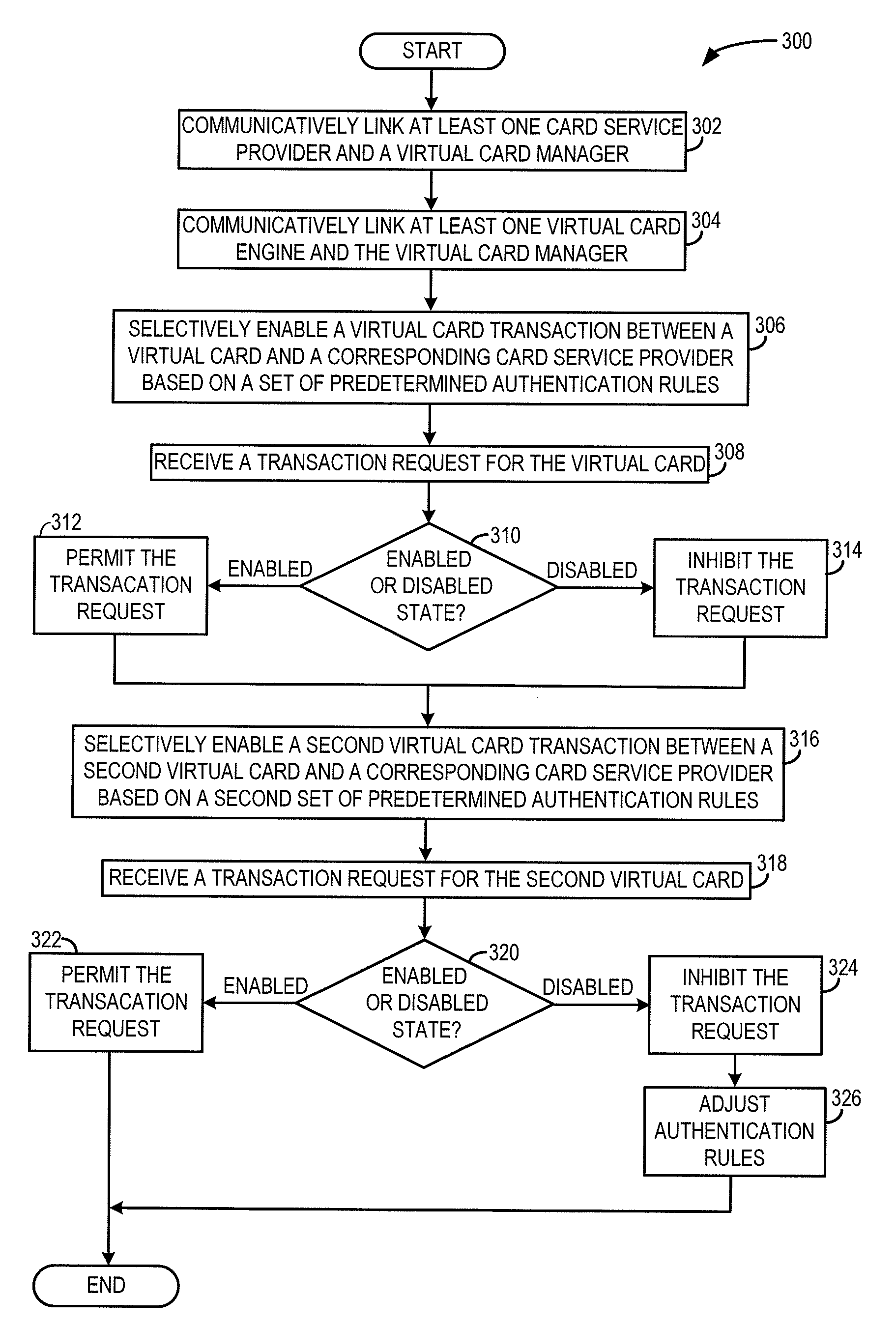

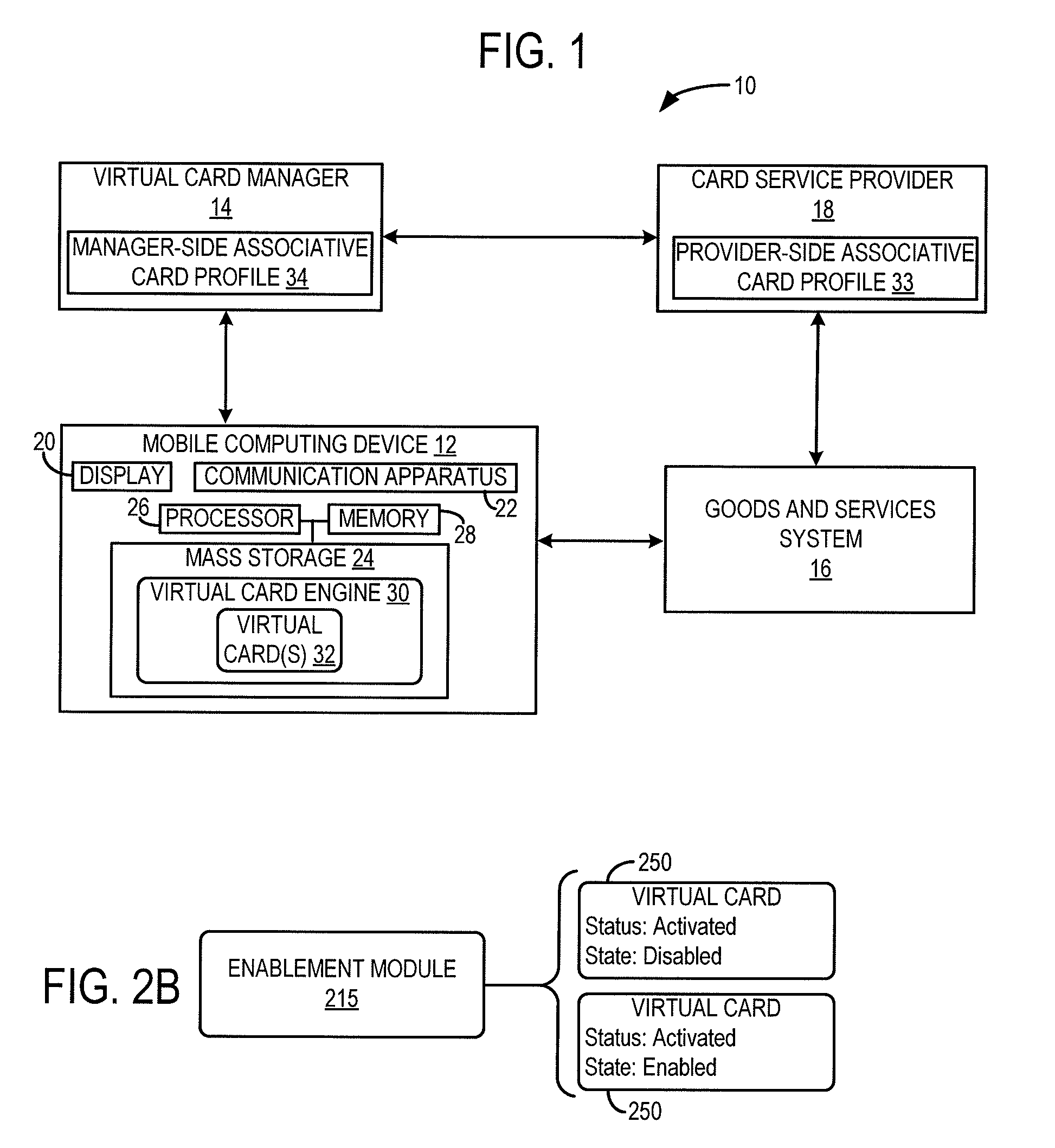

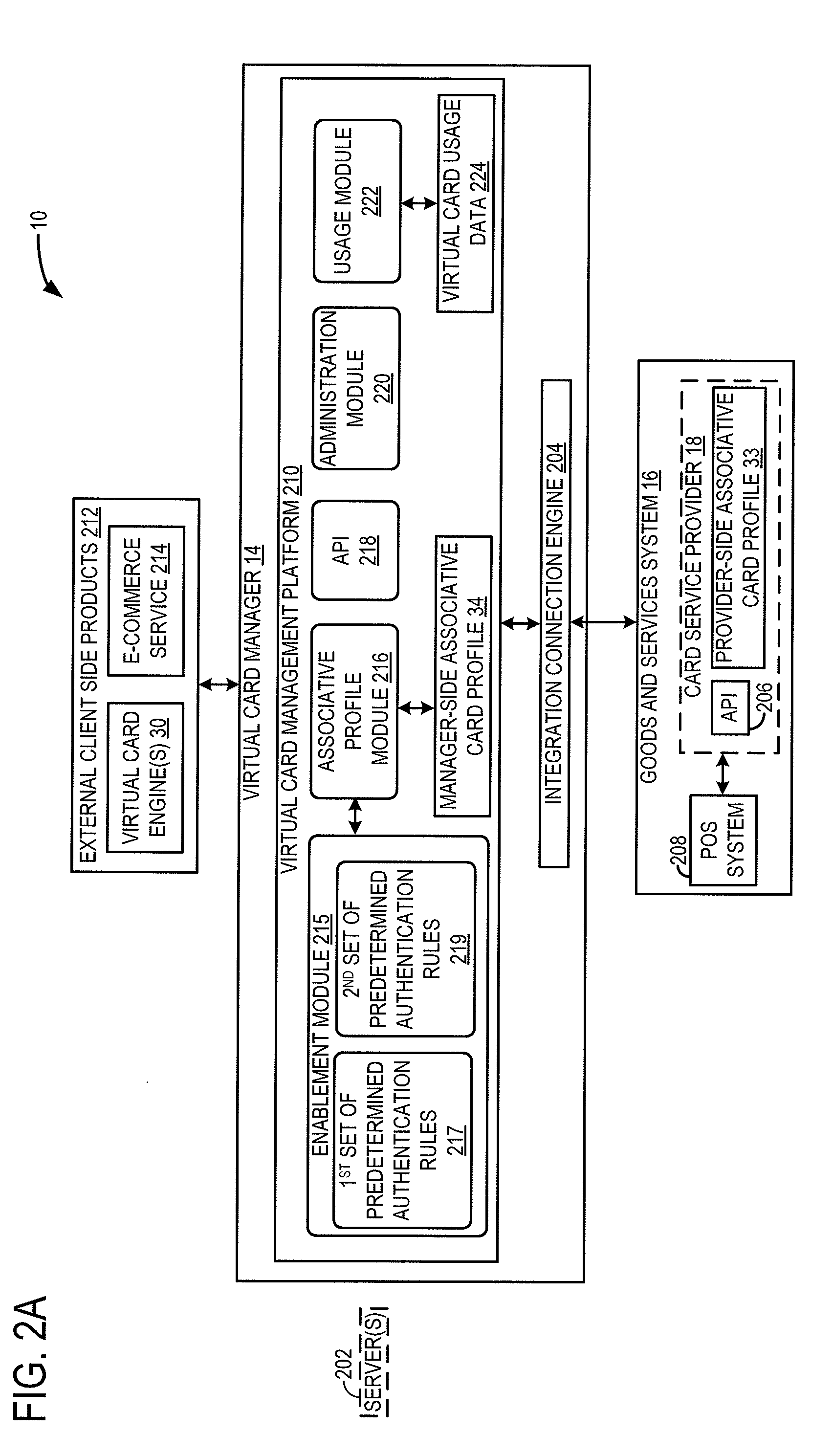

A virtual card management system including one or more servers having memory executable via a processor is provided. The virtual card management system including a virtual card manager executable on the one or more servers having an integration connector engine configured to communicatively link at least one card service provider and the virtual card manager. The virtual card management system may further include a virtual card management platform configured to communicatively link the virtual card manager with at least one virtual card engine, each virtual card engine including one or more virtual cards, the virtual card management platform including an enablement module configured to selectively enable a virtual card transaction between at least one virtual card and a corresponding card service provider based on a set of predetermined authentication rules.

Owner:E2INTERACTIVE INC D B A E2INTERACTIVE

System and method for managing stored-value card data

A computerized system and method for managing stored-value card data over a communications network between a plurality of terminals and a central processor is provided. Each of the terminals is accessible to respective users and is located in a respective location generally remote relative to the central processor. The stored-value card data is configured to securely process in real time stored-value cards transacted by respective users to enable charging prepaid stored-value services to a recipient of the transacted stored-value card. The method allows for providing a database coupled to the central processor. The method further allows for storing in the database a plurality of records comprising stored-value card data for each stored-value card. An associating step allows for associating in each stored record respective identifiers to uniquely match a respective stored-value card and a respective terminal. The associating step is enabled by assigning a “setup” card to the location and capturing the terminal information when a transaction utilizing that card is made. A transmitting step allows for transmitting a request of stored-value card activation to the central processor from a respective requesting terminal, the central processor configured to accept said activation request based on whether the associated identifiers for the stored-value card to be activated match identifiers actually transmitted by the requesting terminal for that stored-value card and terminal.

Owner:E2INTERACTIVE INC D B A E2INTERACTIVE

Method and system of detecting cash deposits and attributing value

InactiveUS20060213980A1Improved bank processing systemPrevent fraudComplete banking machinesFinanceOperating systemStored-value card

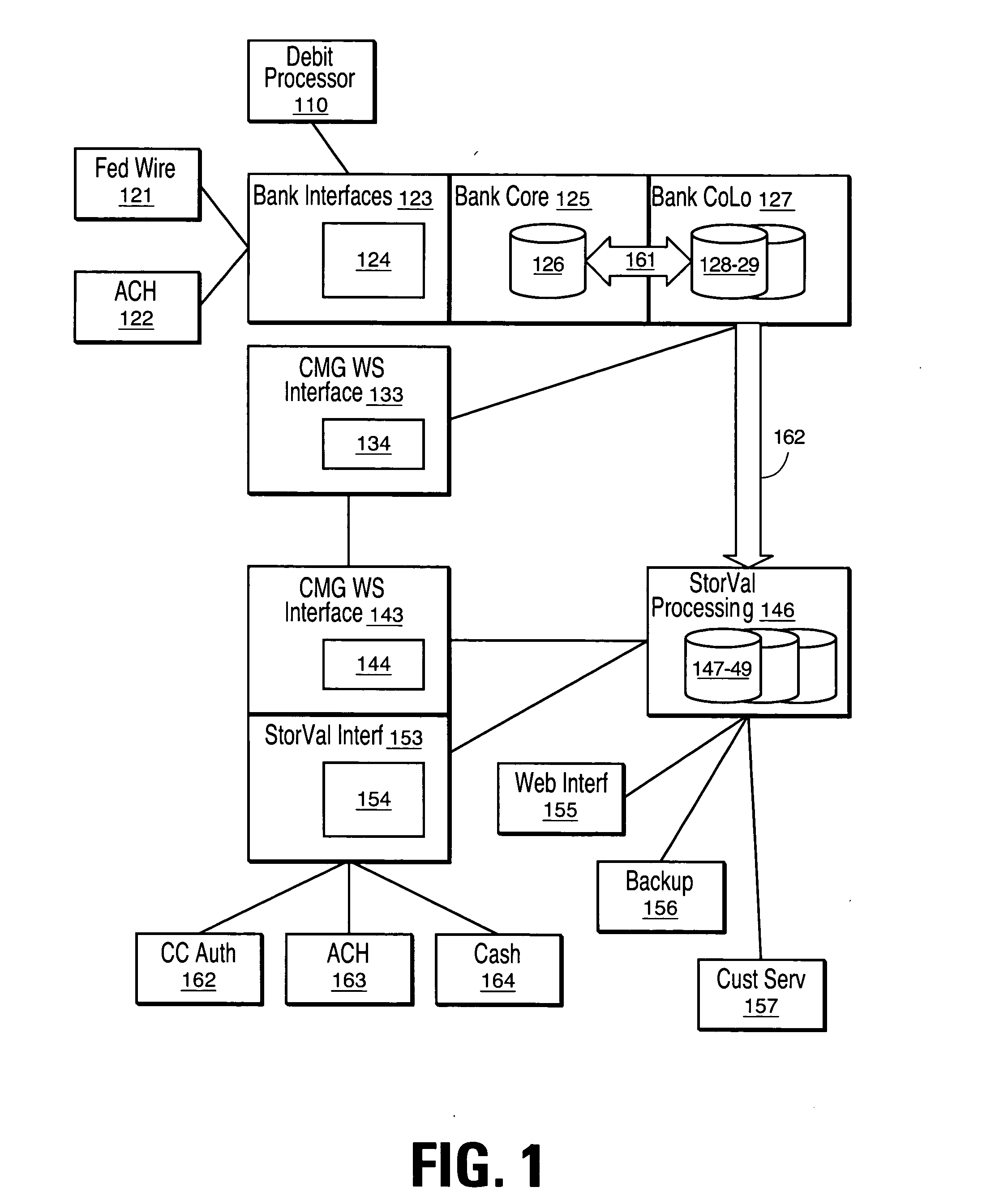

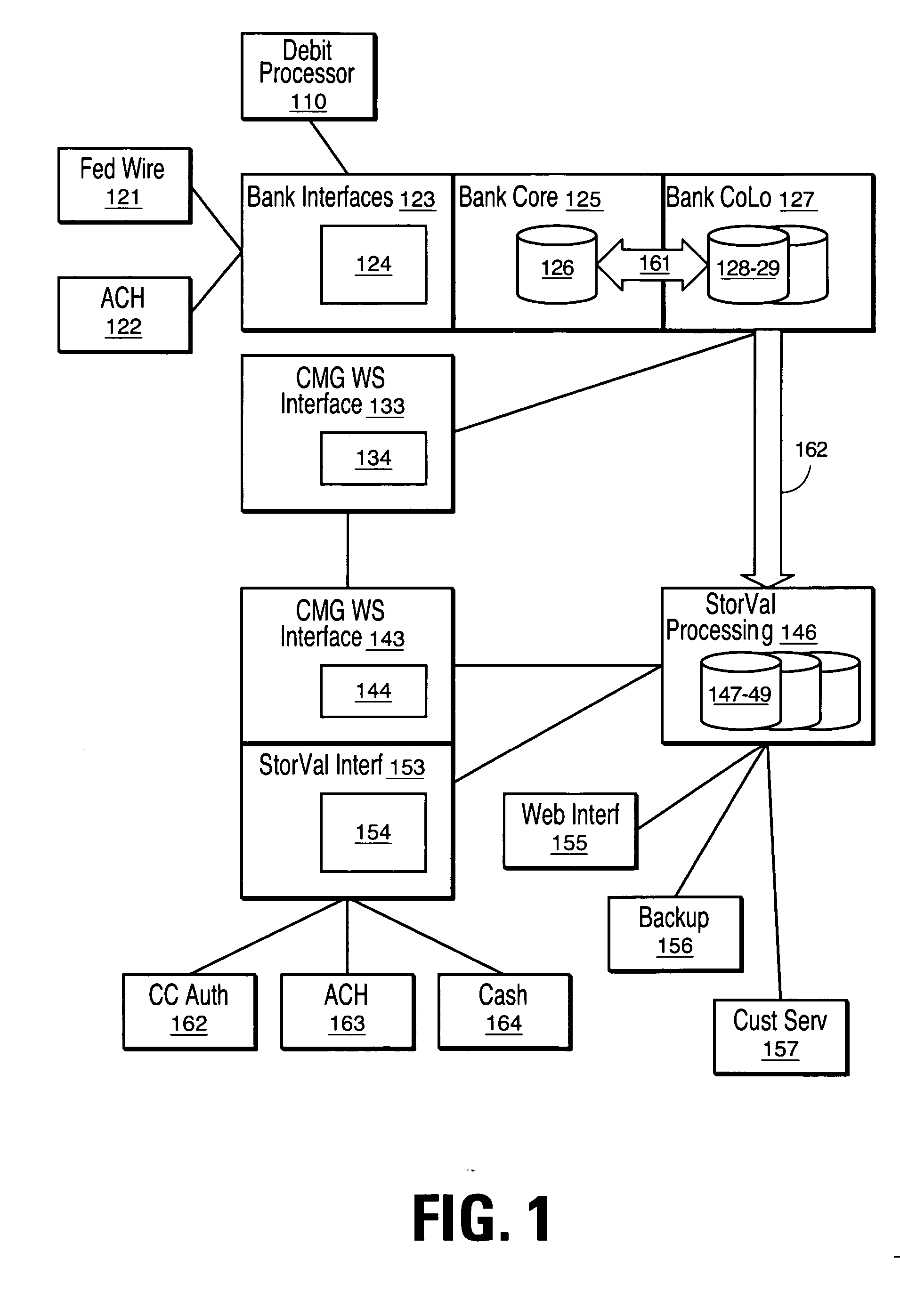

The present invention relates to stored value cards and improved bank processing systems. In particular, it relates to systems and methods that load value into demand deposit and plastic account number accounts corresponding to the stored value card and make funds available without delay, even for the unbanked. It also relates to methods for avoiding fraud.

Owner:BLUKO INFORMATION GROUP

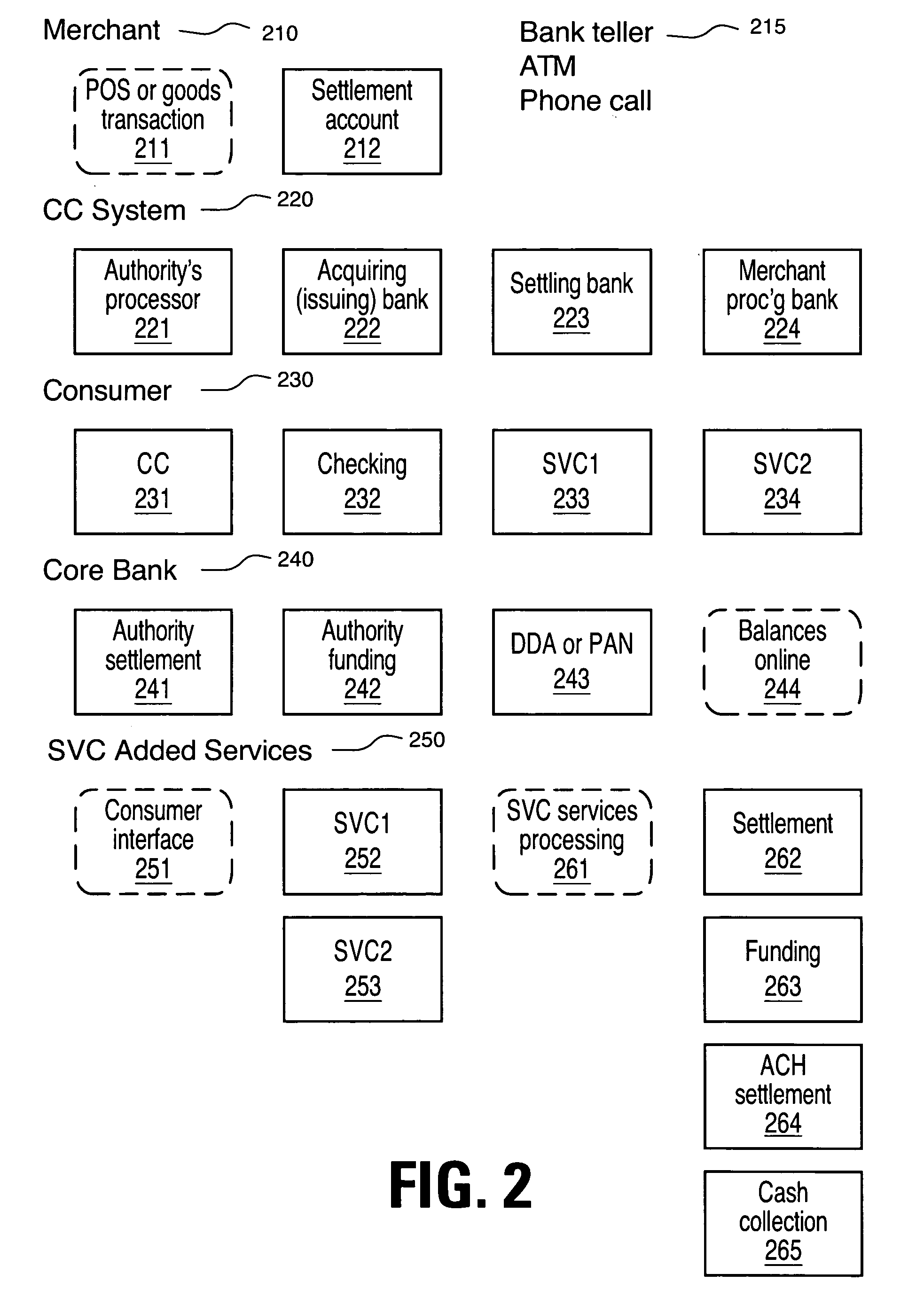

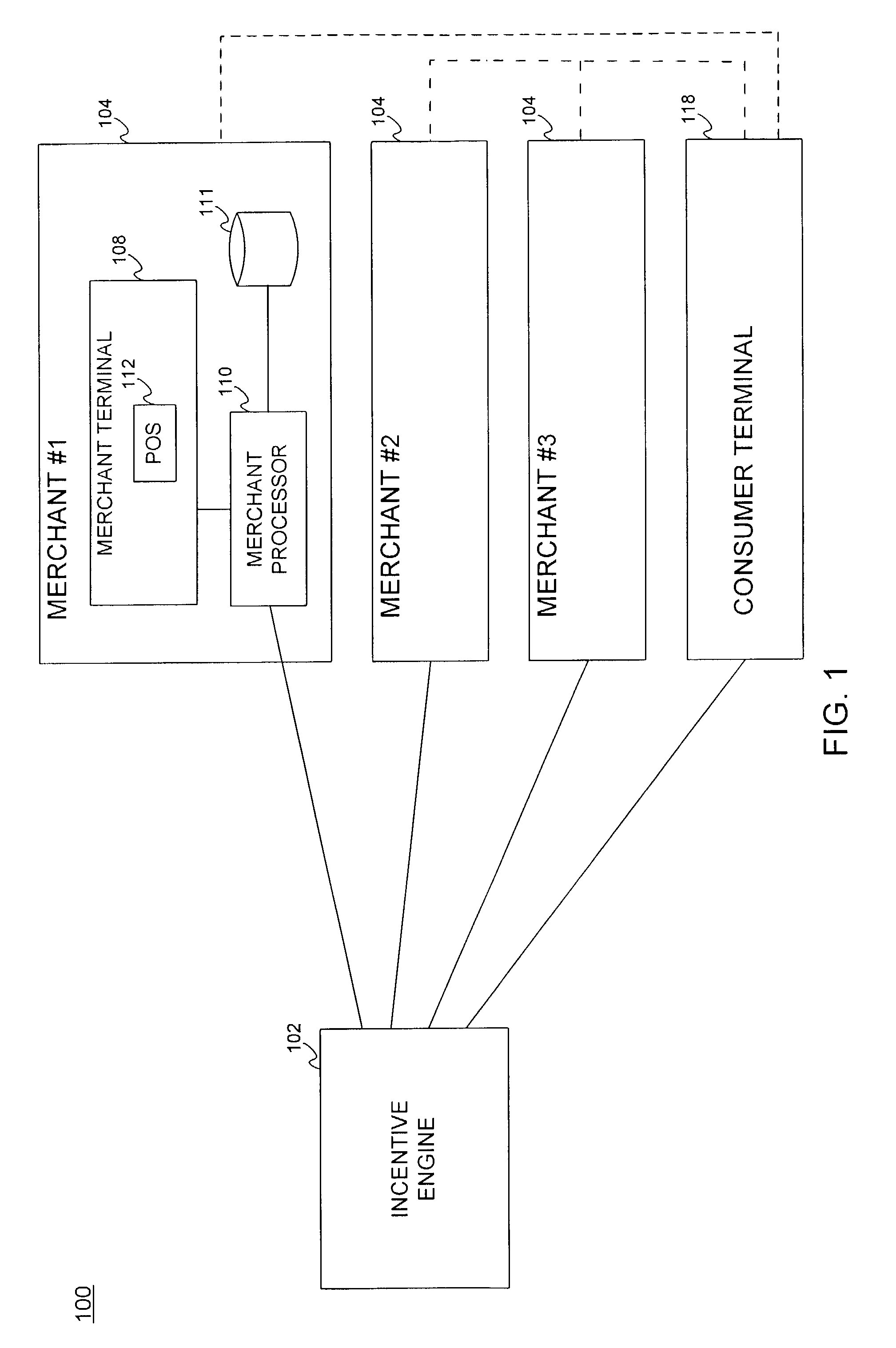

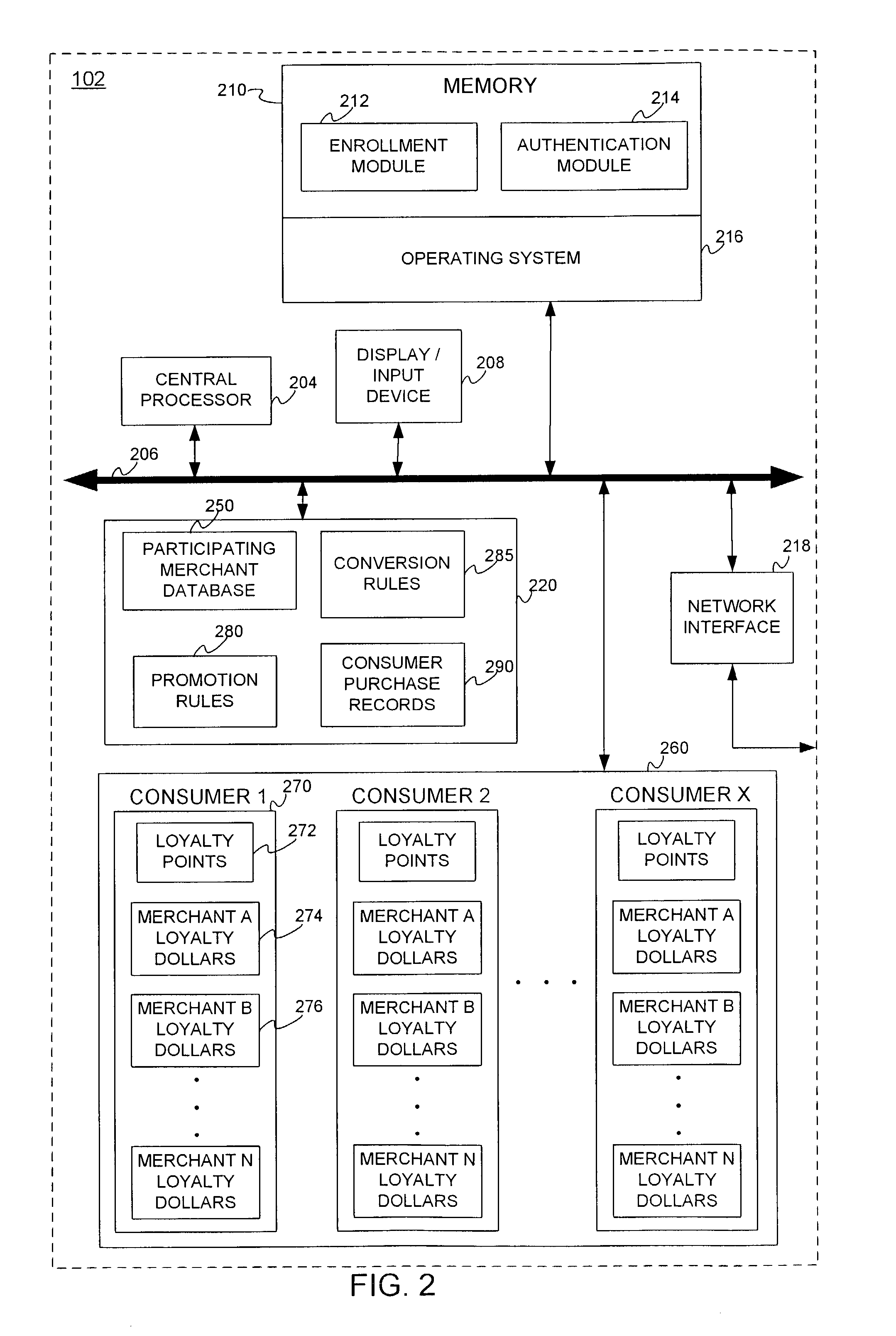

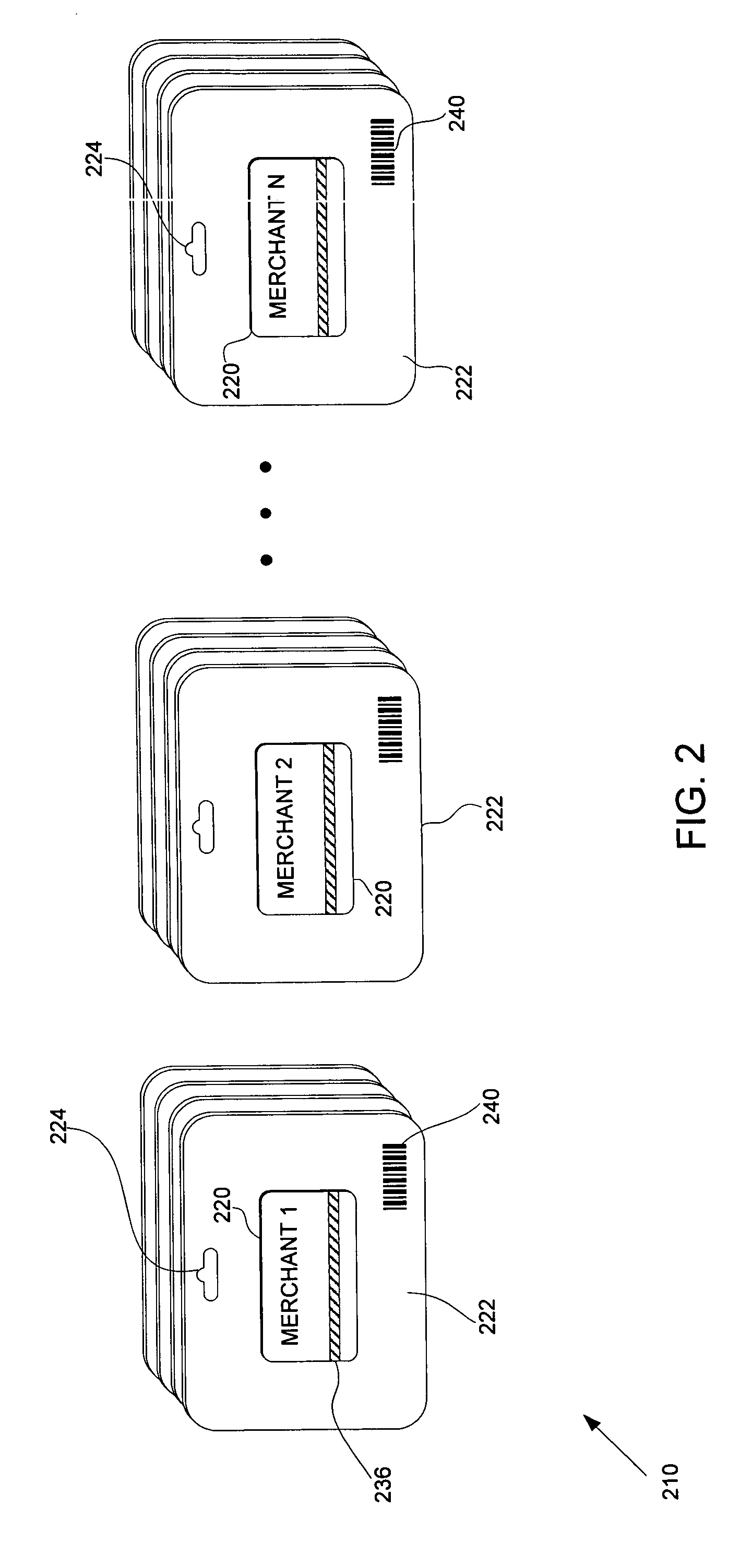

System and method for a multiple merchant stored value card

InactiveUS7606730B2Facilitates redemptionCredit registering devices actuationPoint-of-sale network systemsSmart cardDatabase

The loyalty system allows a consumer to accumulate general loyalty points from one or more merchants, and convert any desired subset of general points to loyalty dollars associated with a specific merchant. The system stores, for each consumer, the merchant loyalty dollars (or monetary equivalent) by merchant within a remotely-accessible host database or within a smart card database. Upon conducting a purchase at a particular merchant, the consumer may utilize a code key to facilitate access to the consumer's own loyalty dollars for the particular merchant. The loyalty dollars are then applied to the purchase transaction as a discount or rebate. The consumer may also re-load the merchant loyalty dollar accounts.

Owner:LIBERTY PEAK VENTURES LLC +1

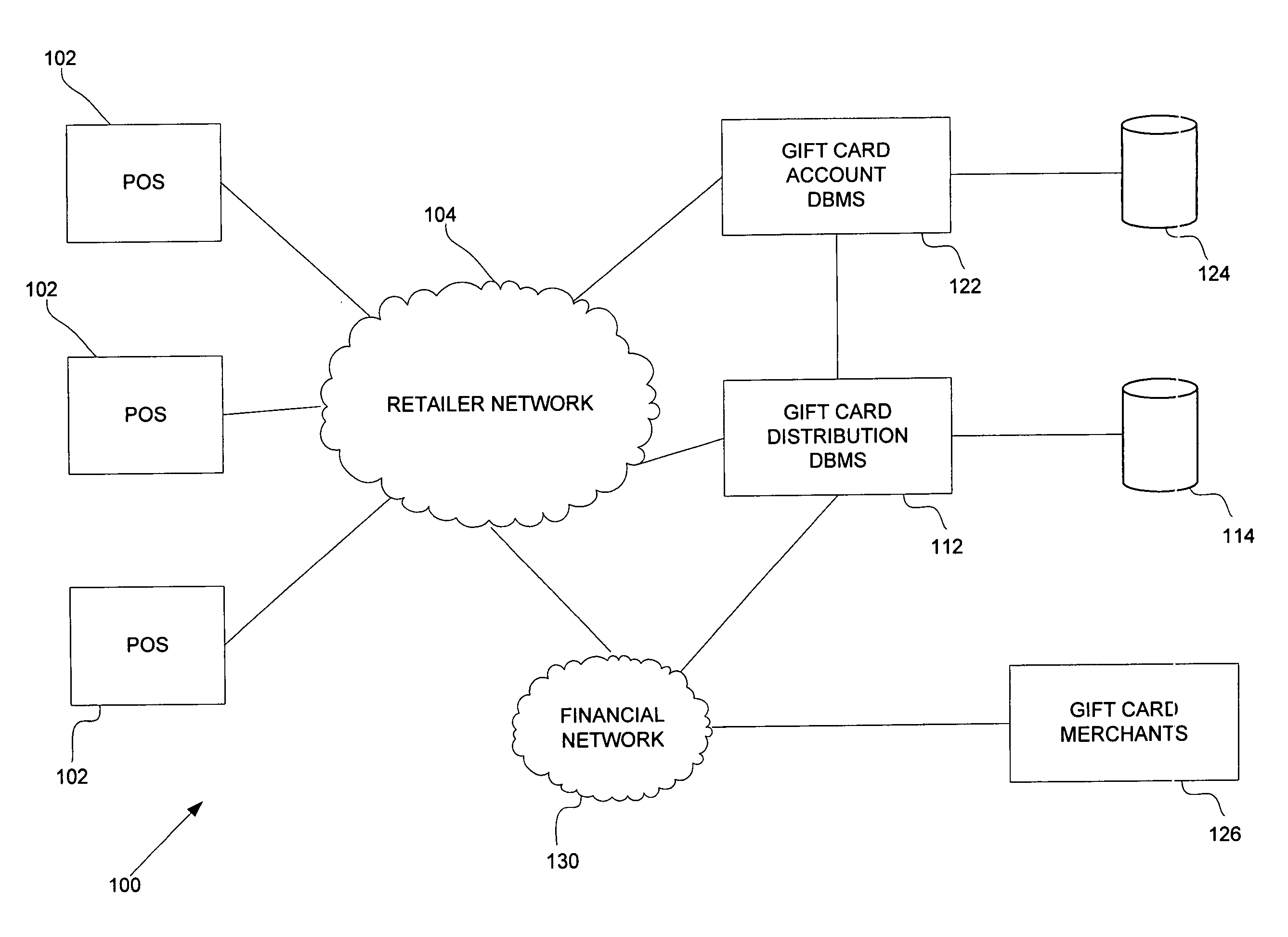

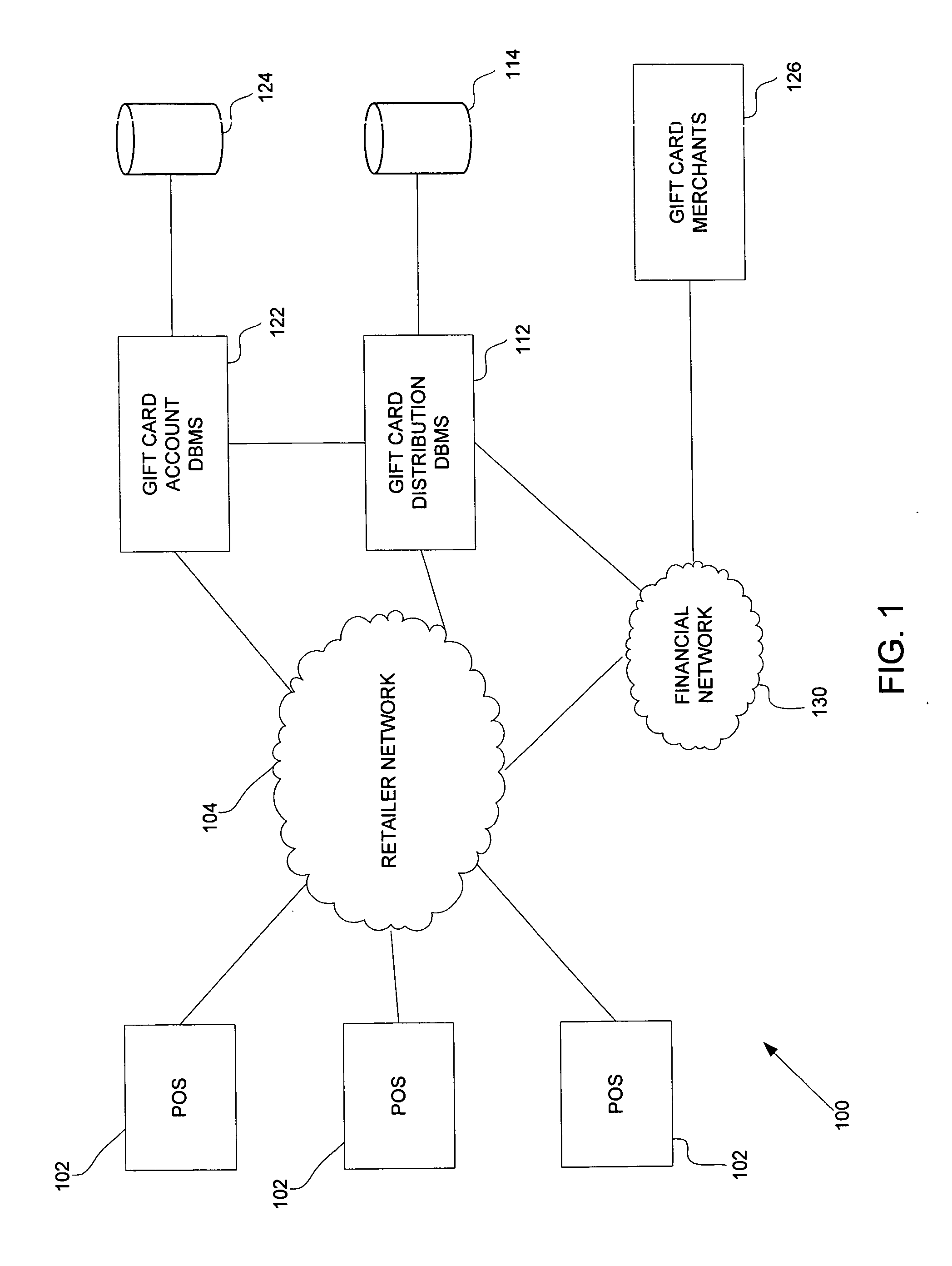

System and method for accounting for activation of stored value cards

ActiveUS20060249570A1Complete banking machinesAcutation objectsComputer hardwareBiological activation

Stored value cards, such as gift cards, from different card issuers are displayed for sale and activation at retail locations. A distribution database system maintains records of cards sold at the retail locations. The system accounts to each retailer for commissions owed for cards sold by that retailer, and accounts to each card issuer for its cards that are sold at each retail location.

Owner:THE WESTERN UNION CO

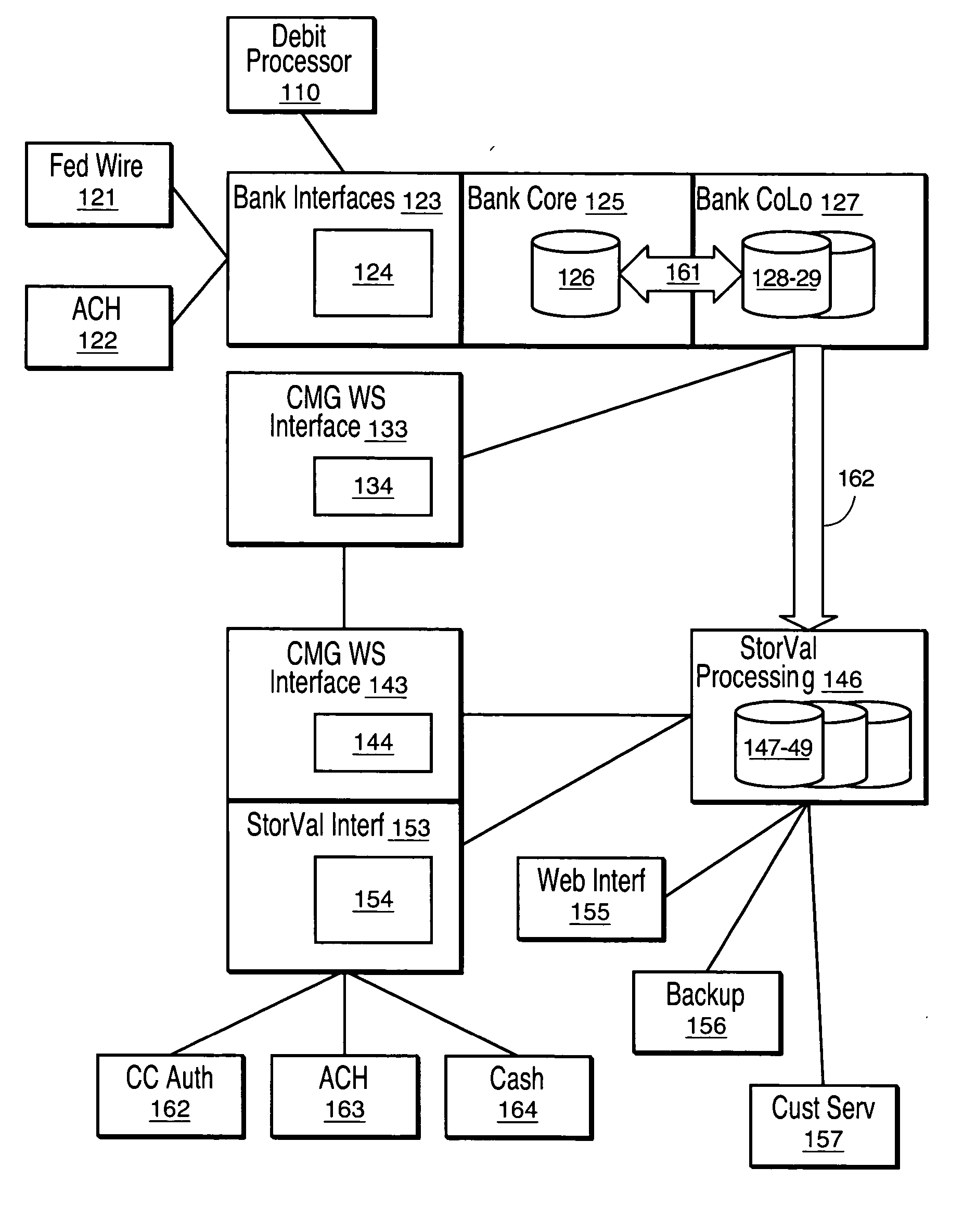

Methods and systems for processing, accounting, and administration of stored value cards

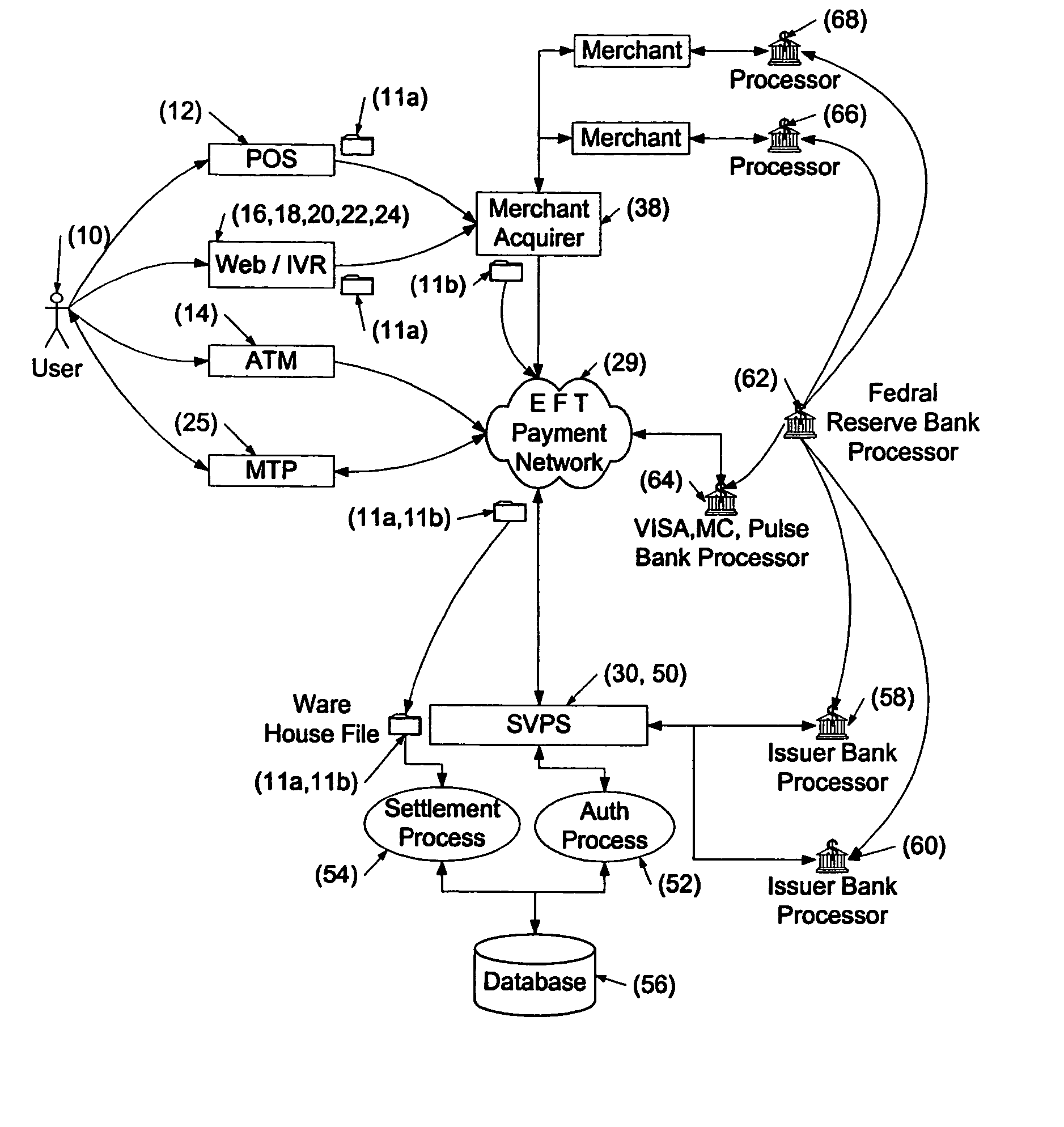

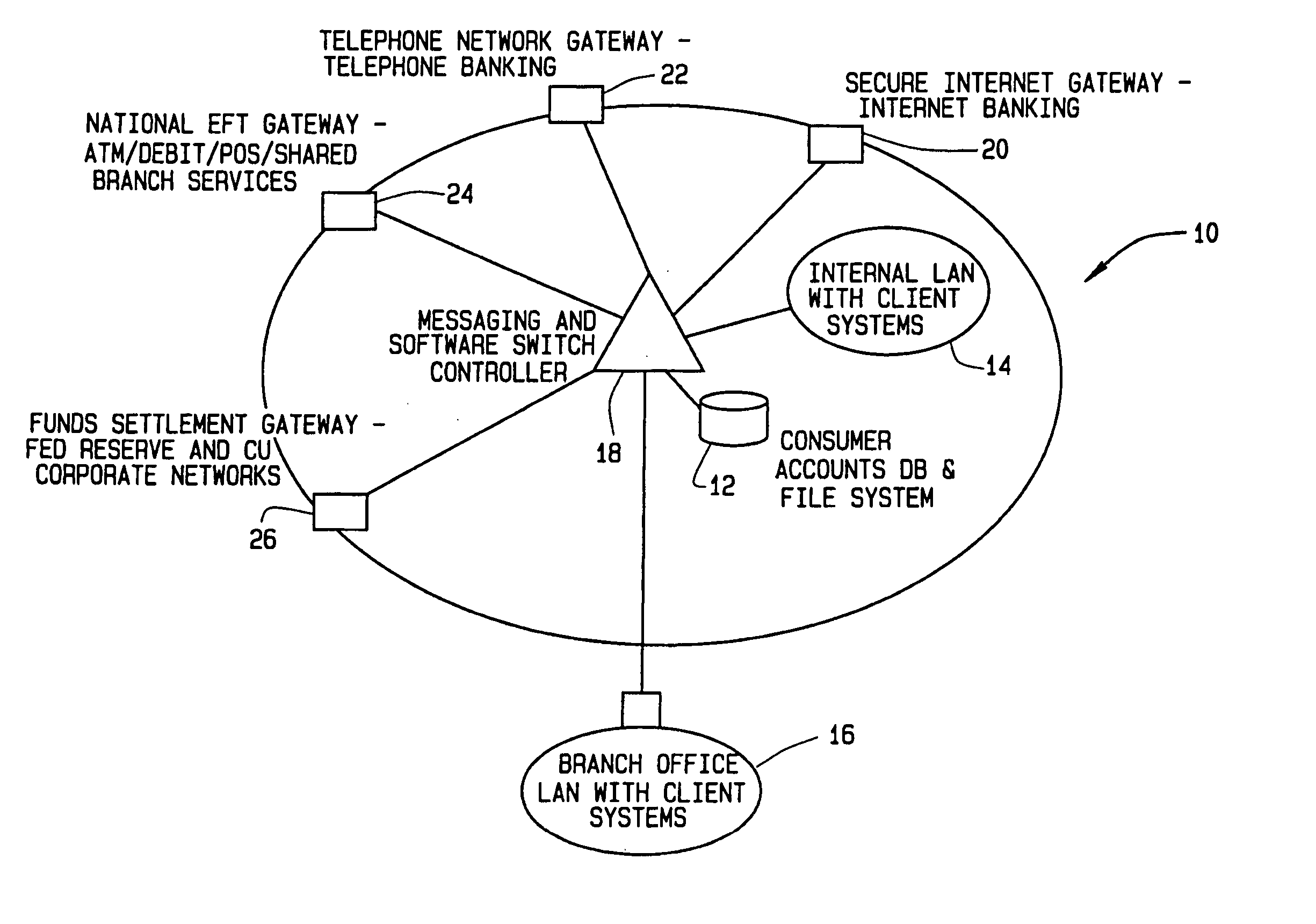

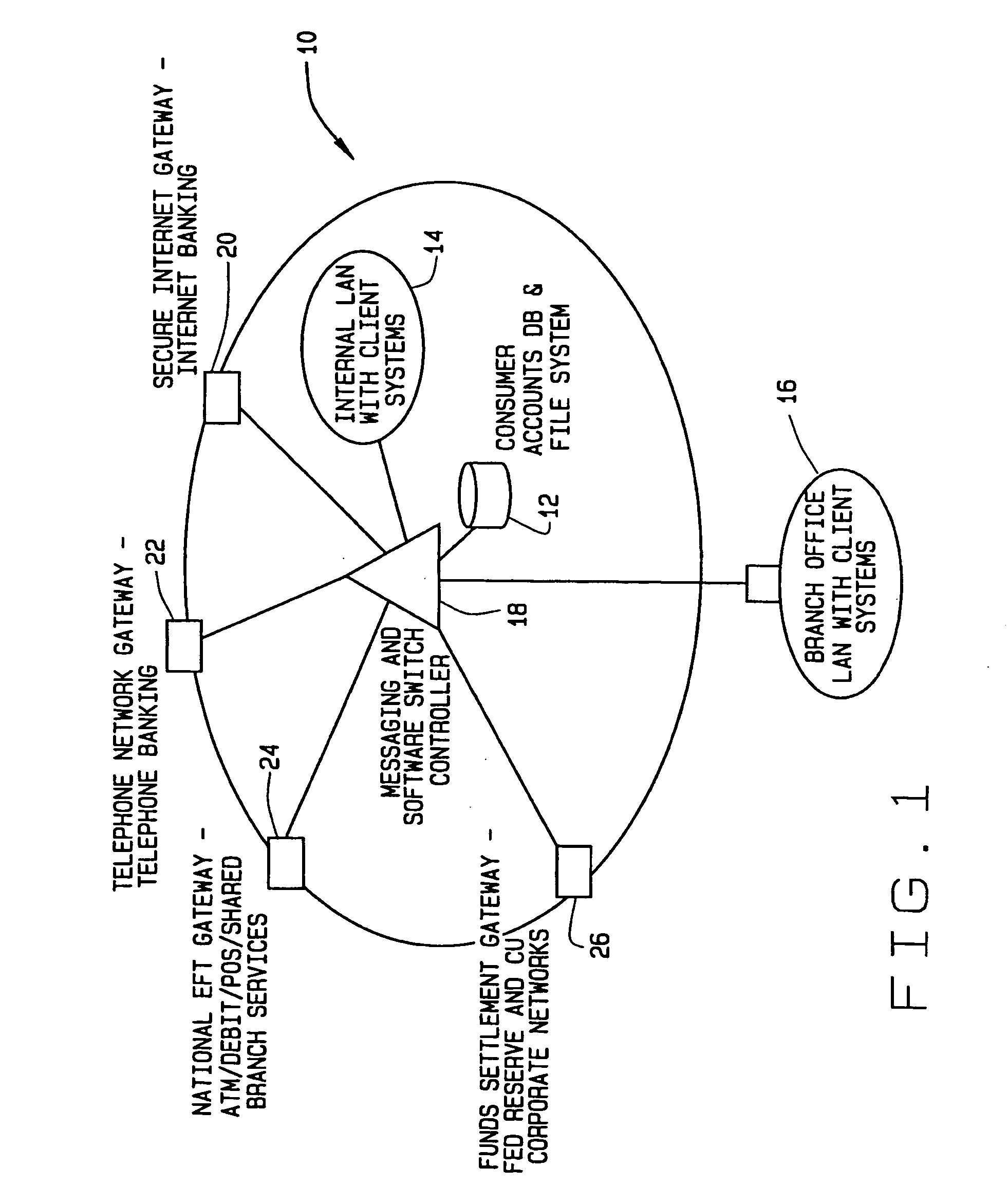

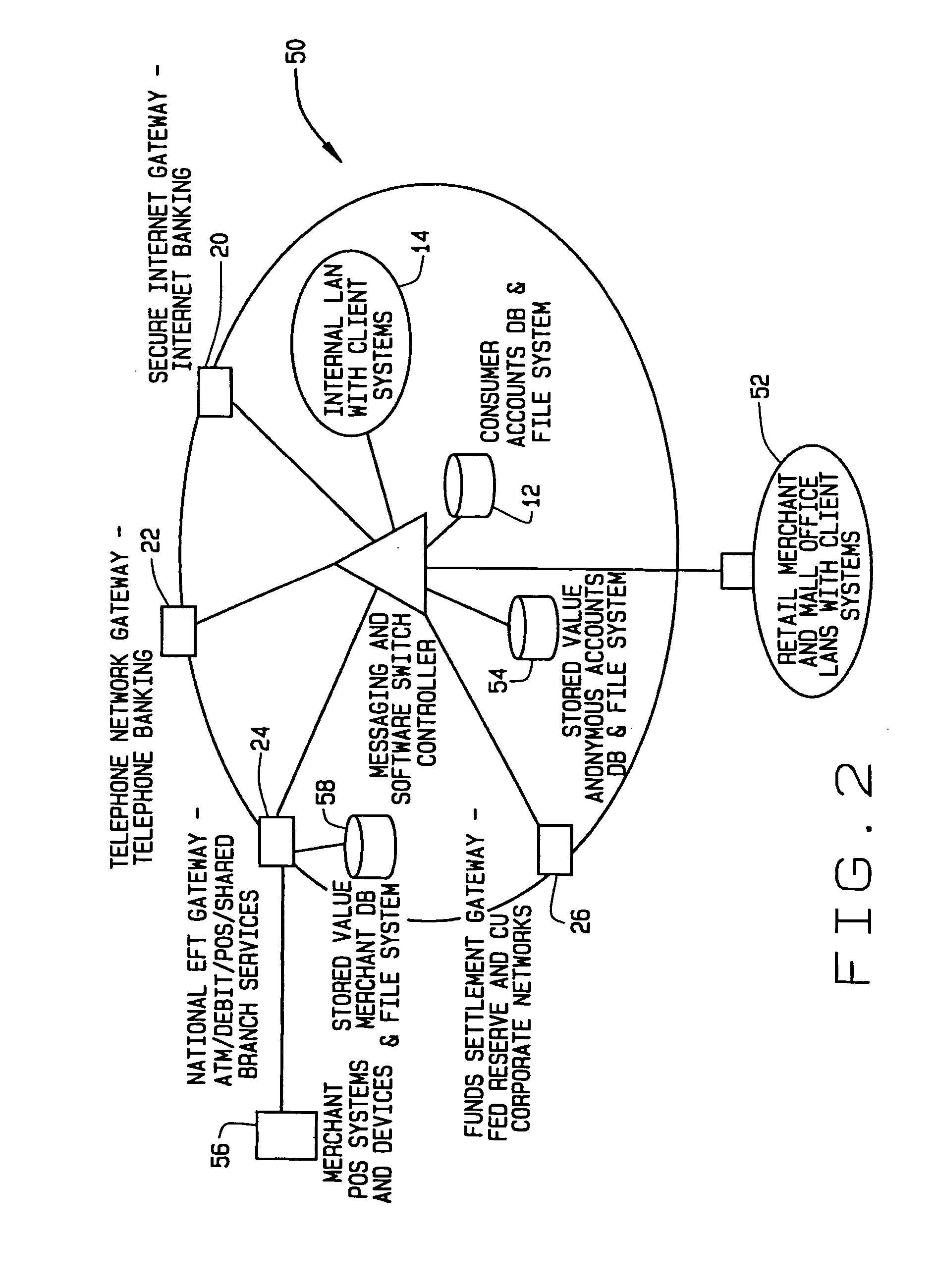

Methods are described for accounting, administration and processing of transactions utilizing a stored value card utilizing an EFT service gateway and providing balances for the cards across a plurality of point of sale devices. One method includes receiving a message generated by the point of sale system of a merchant and parsing the message into data elements. The method also includes routing the message through a switch controller to an account holder database based on an institution ID and a branch ID, accessing an account within the database utilizing the account key, and determining if an account holder's monetary balance in the account is greater than or equal to the transaction amount. A message is formatted and one of an authorization approval or a denial based upon the determination is transmitted within the message.

Owner:STOREFINANCIAL LLC +1

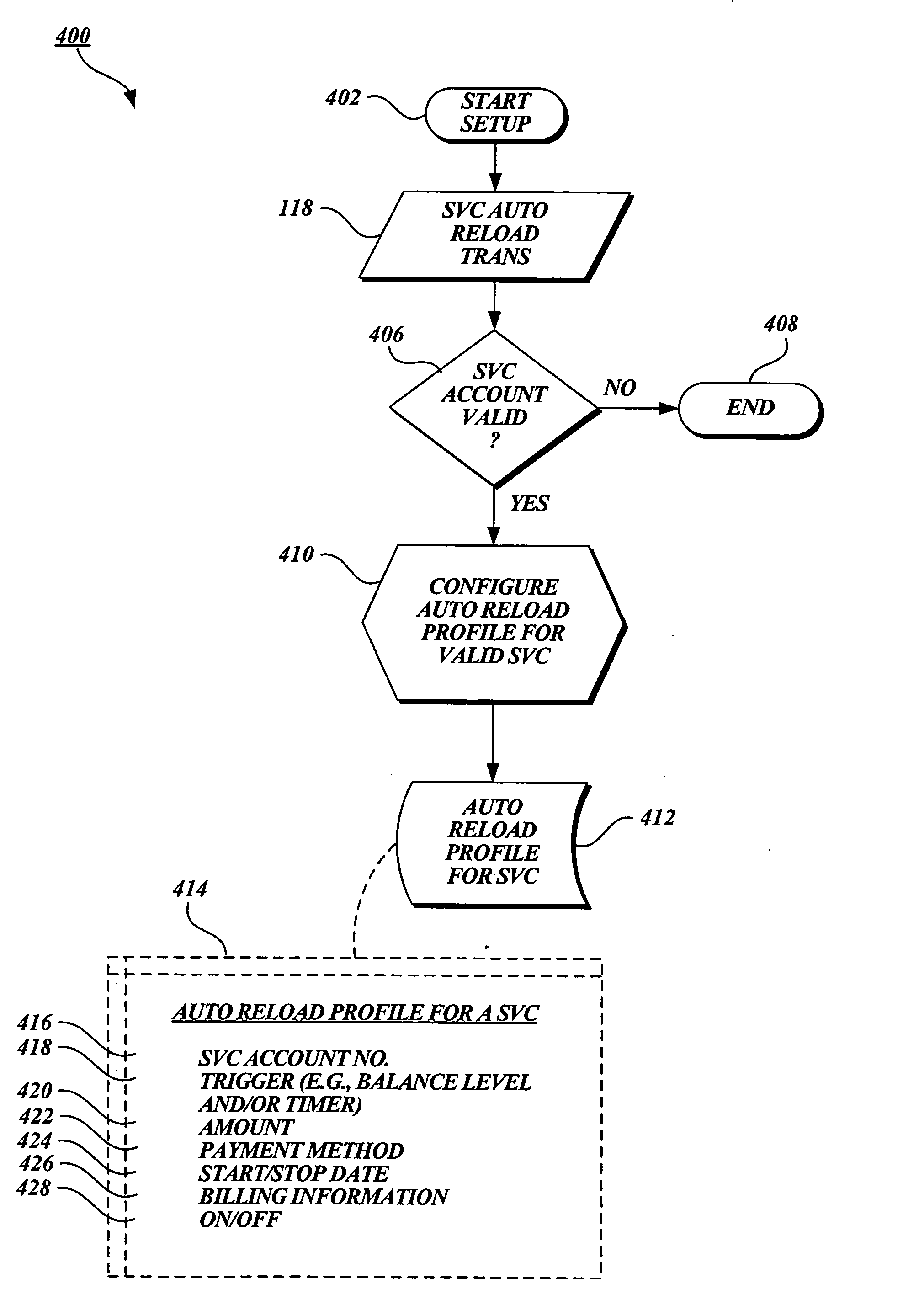

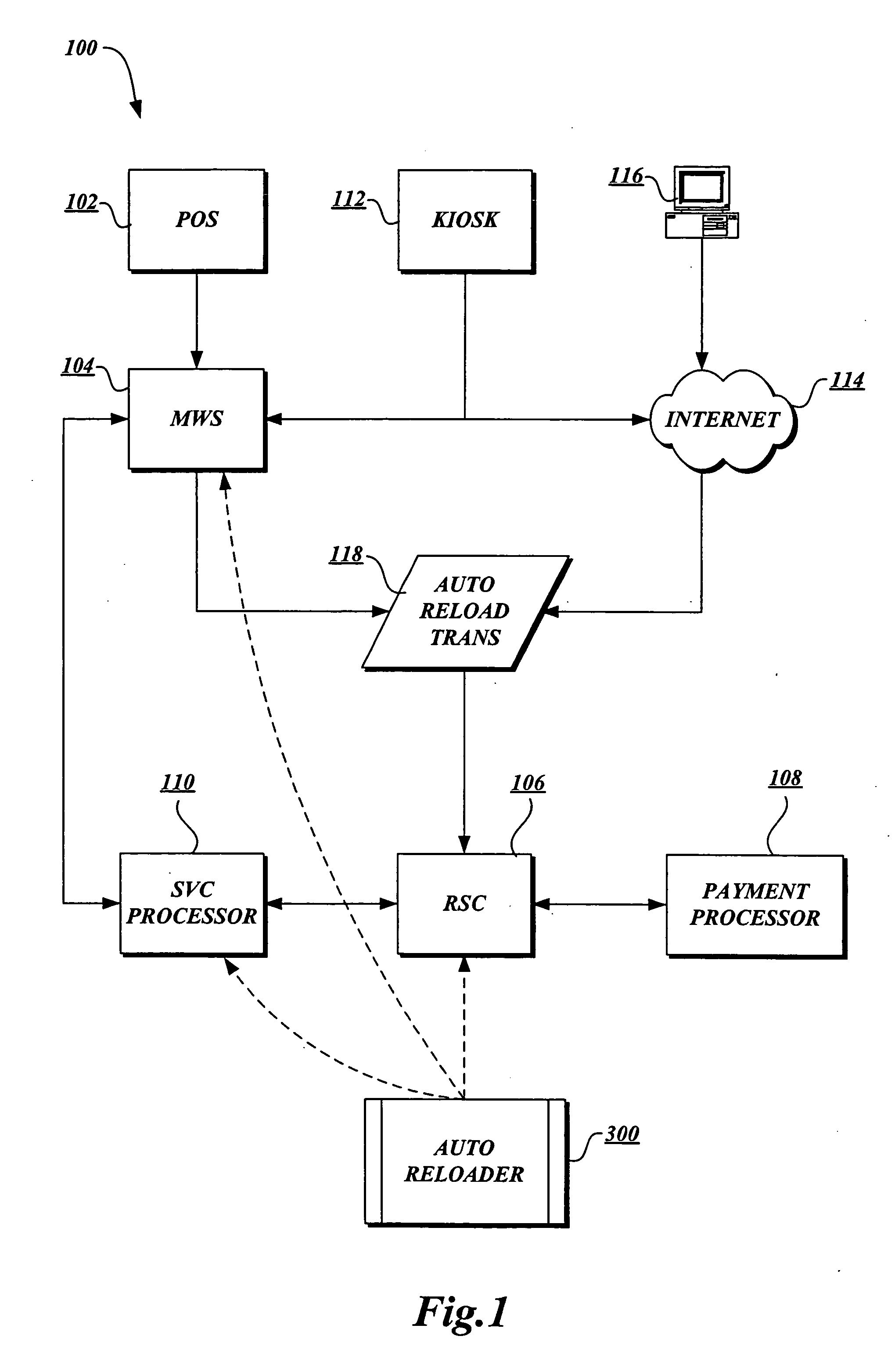

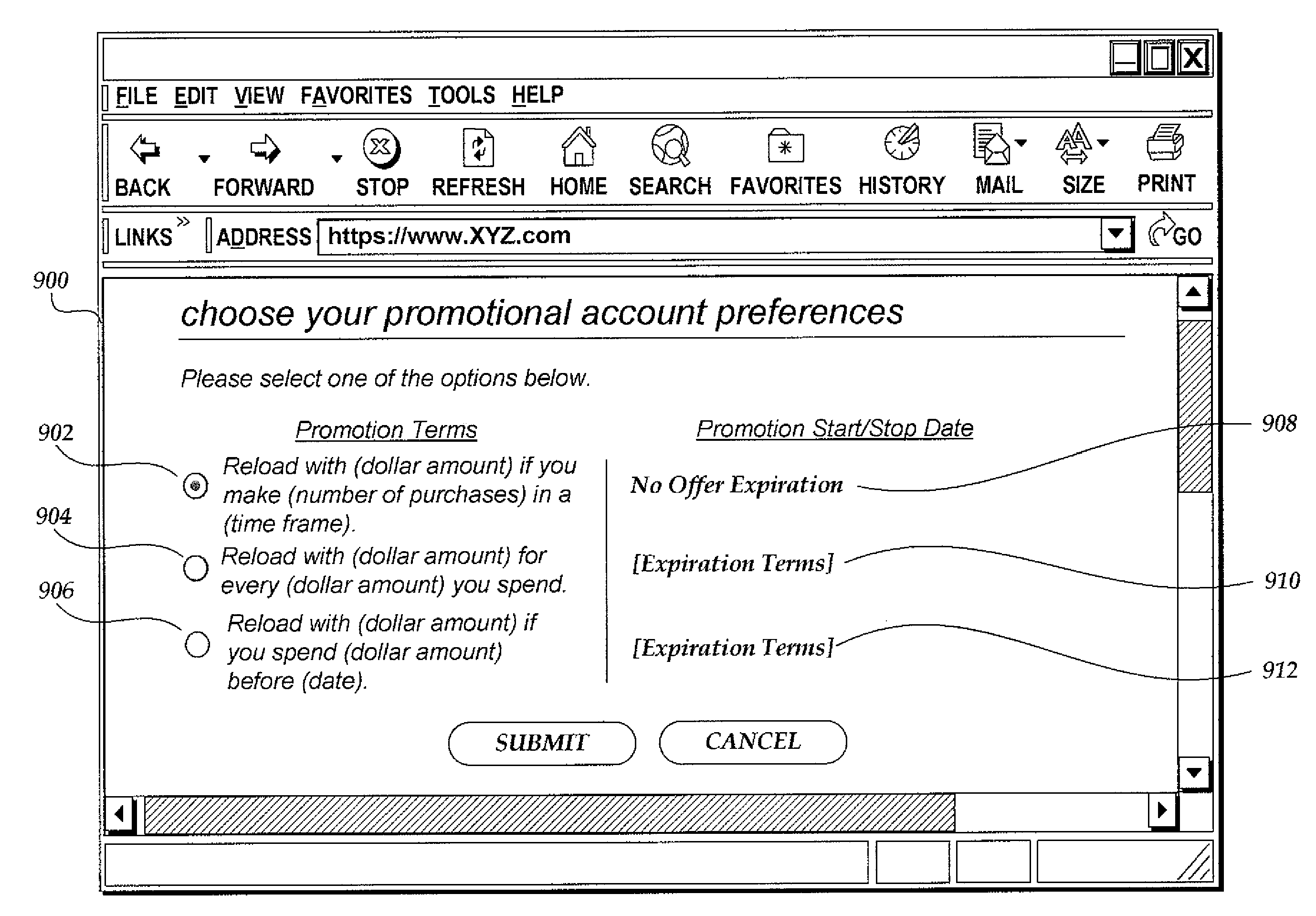

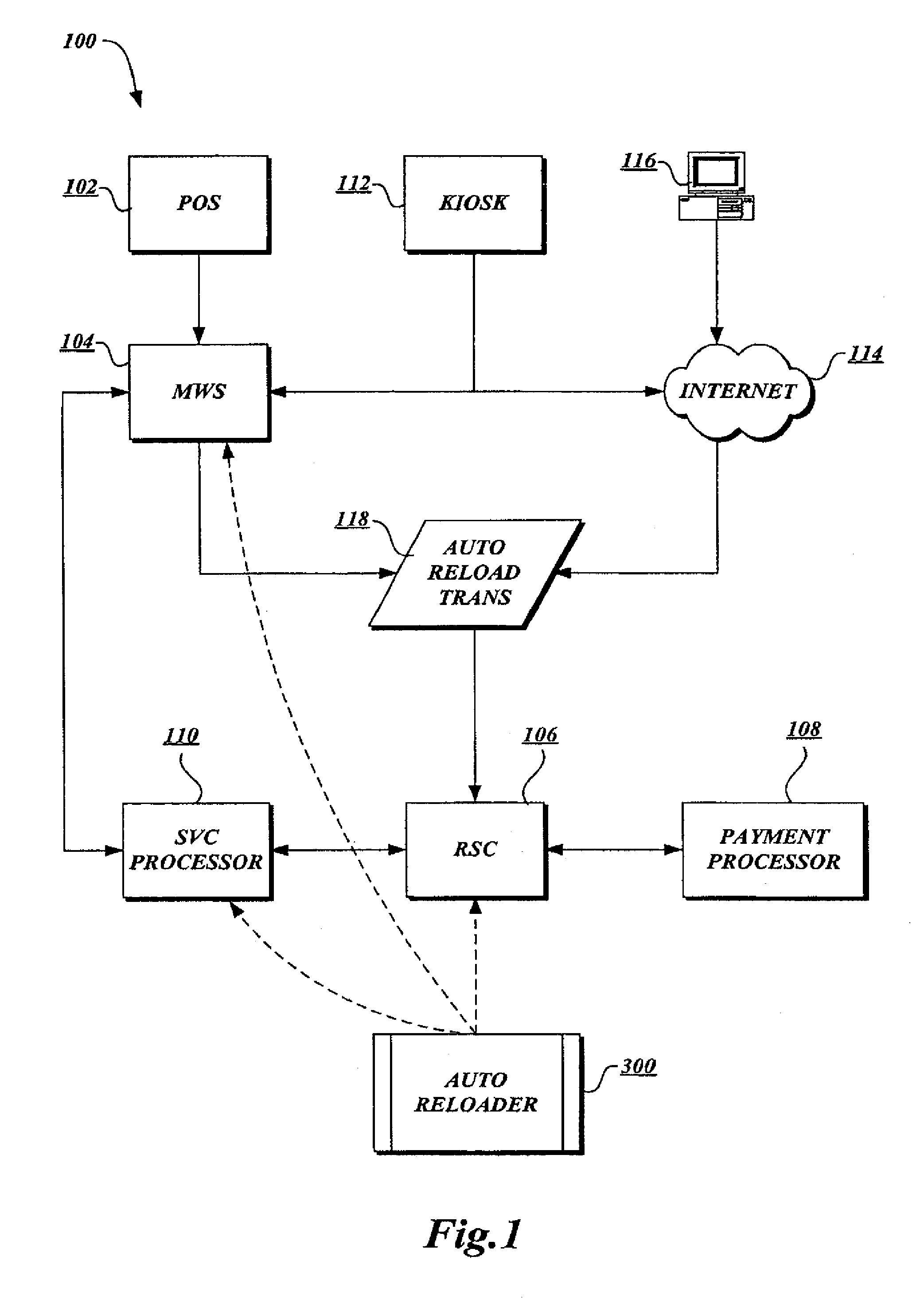

Method and apparatus for automatically reloading a stored value card

To facilitate the sale of merchandise using a stored value card (SVC), a method and system are provided to automatically reload an SVC in accordance with automatic reload preferences associated with the SVC account. The preferences include the pre-authorized reload amount, payment method, and the circumstances under which to automatically reload the SVC with the pre-authorized reload amount. The preferences are previously specified by a party associated with the SVC when setting up the automatic reload option. The party is notified when the automatic reload occurs.

Owner:STARBUCKS

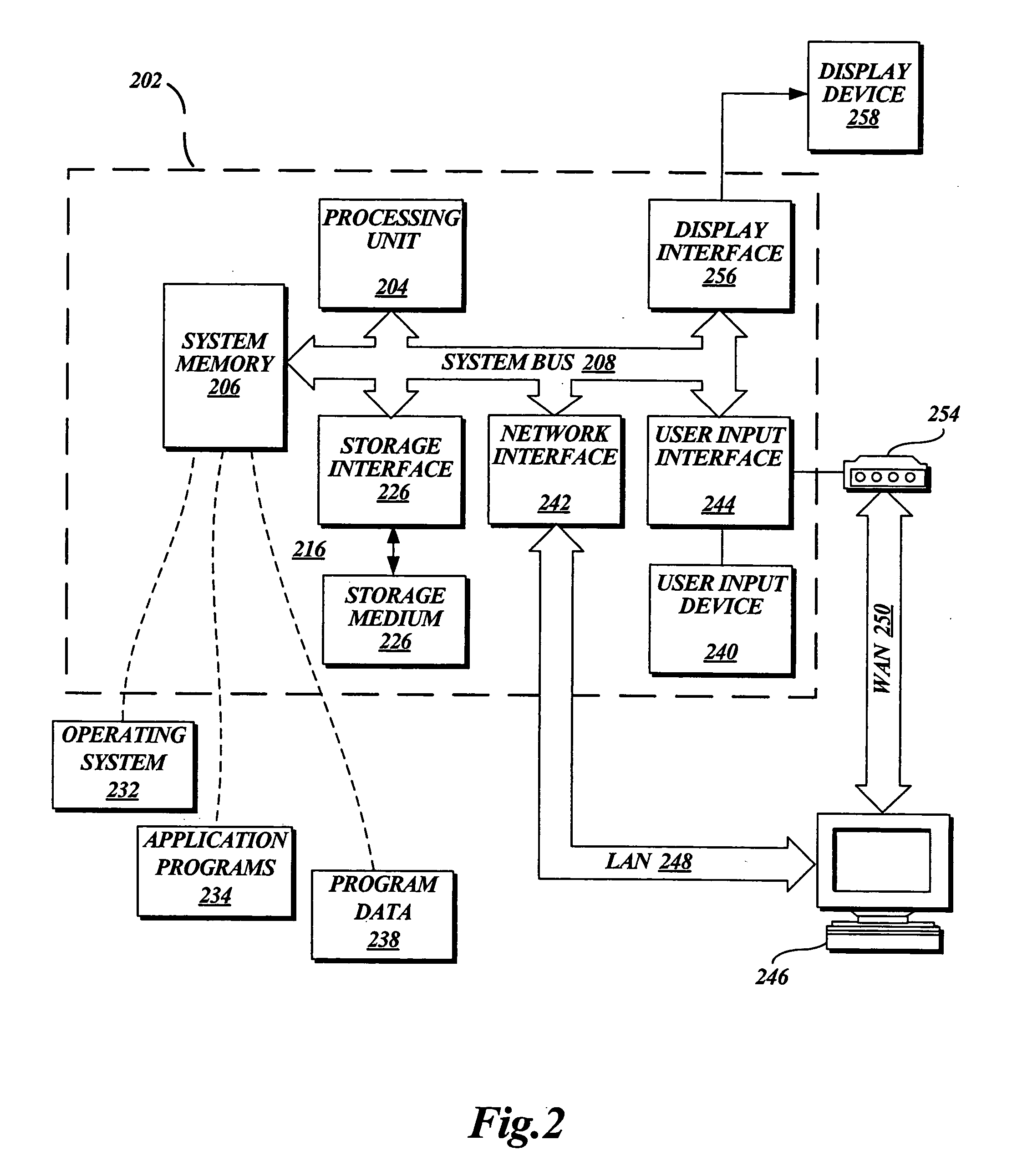

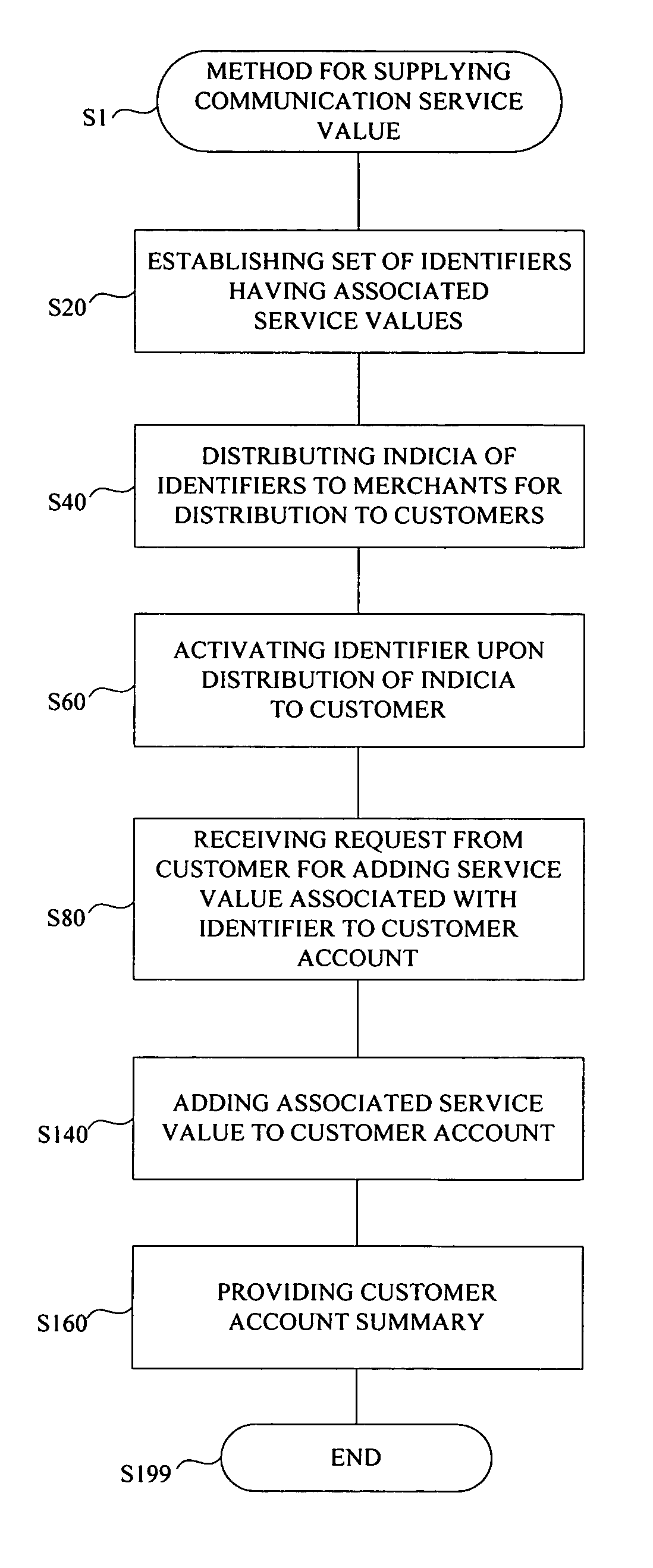

System and method for distributing stored-value cards

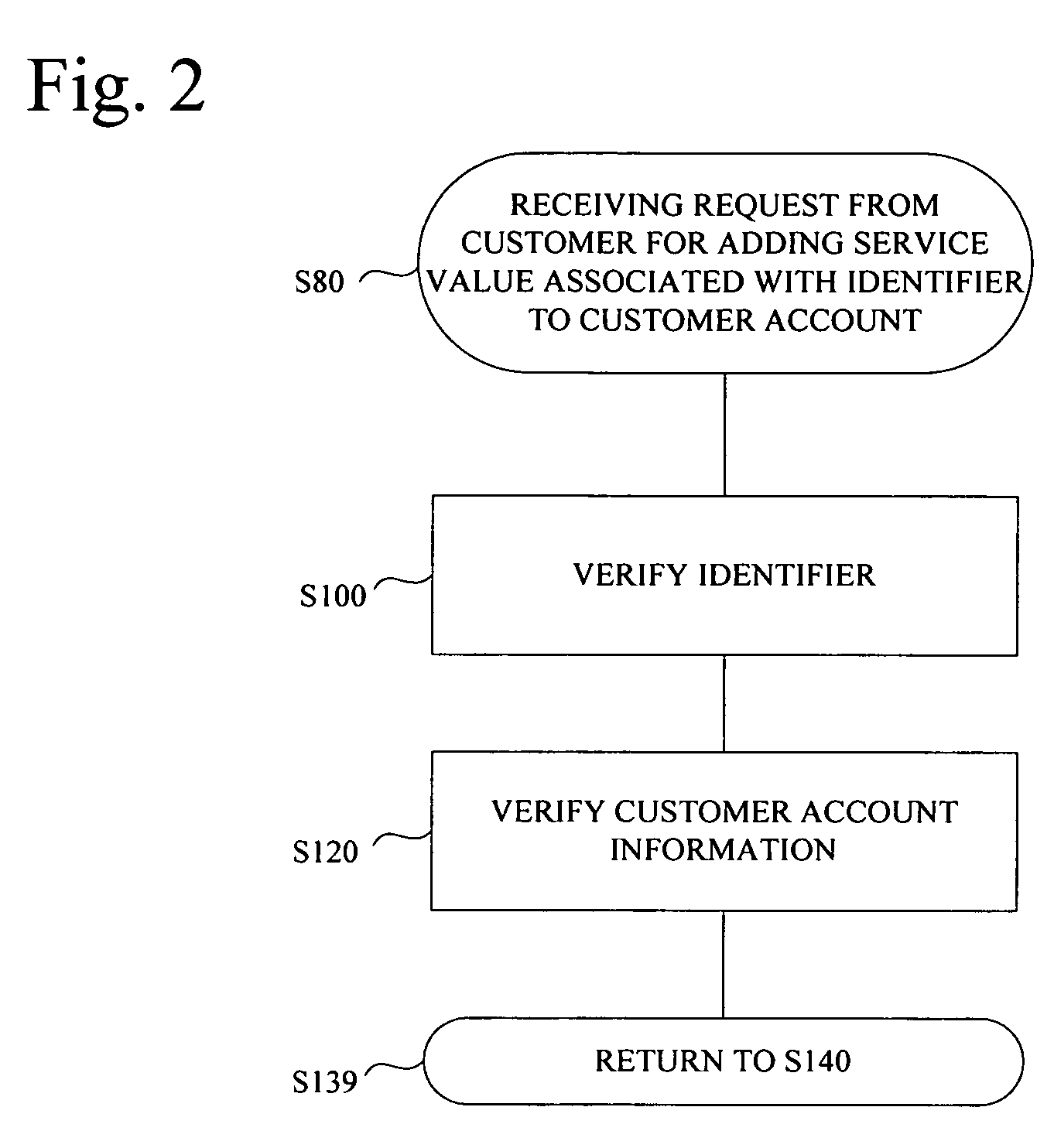

A system and method for supplying communication service value is disclosed. In one embodiment, the method includes distributing indicia of an identifier to a merchant for distribution to a customer having a customer account. The identifier has an associated service value that is redeemable with a plurality of carriers. The method further includes activating the identifier upon distribution of the indicia to the customer. A central processor may verify whether the merchant is authorized to distribute the indicia to the customer. During distribution to the customer, the merchant may transmit prior transaction information to the central processor, and the central processor may reconcile past billing records based on such prior transaction information. The method also includes receiving a request from the customer to add the associated service value to the customer account and adding the associated service value to the customer account is disclosed. The system and method may be used with any type of stored-value card account, including prepaid emergency road service cards.

Owner:E2INTERACTIVE INC D B A E2INTERACTIVE

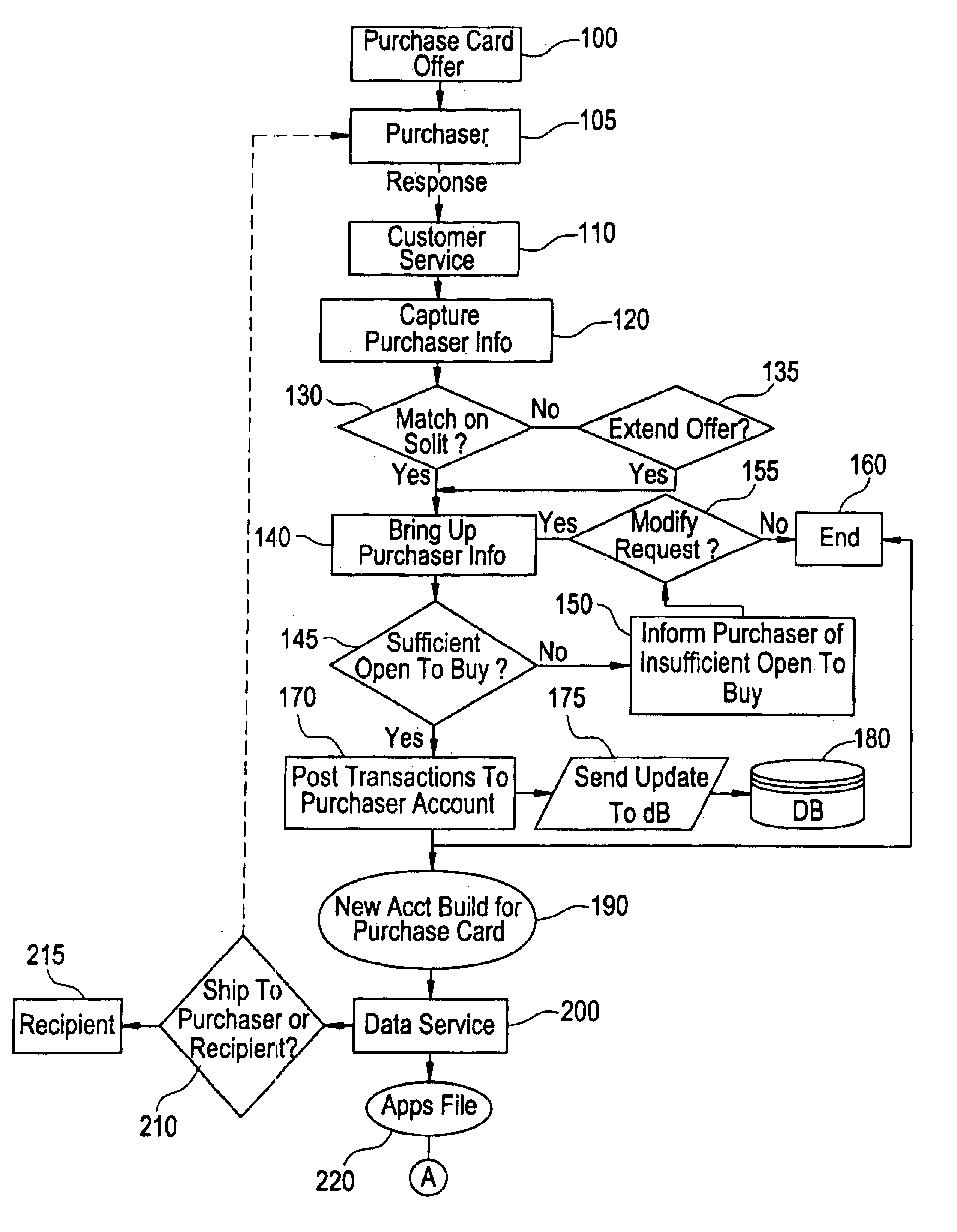

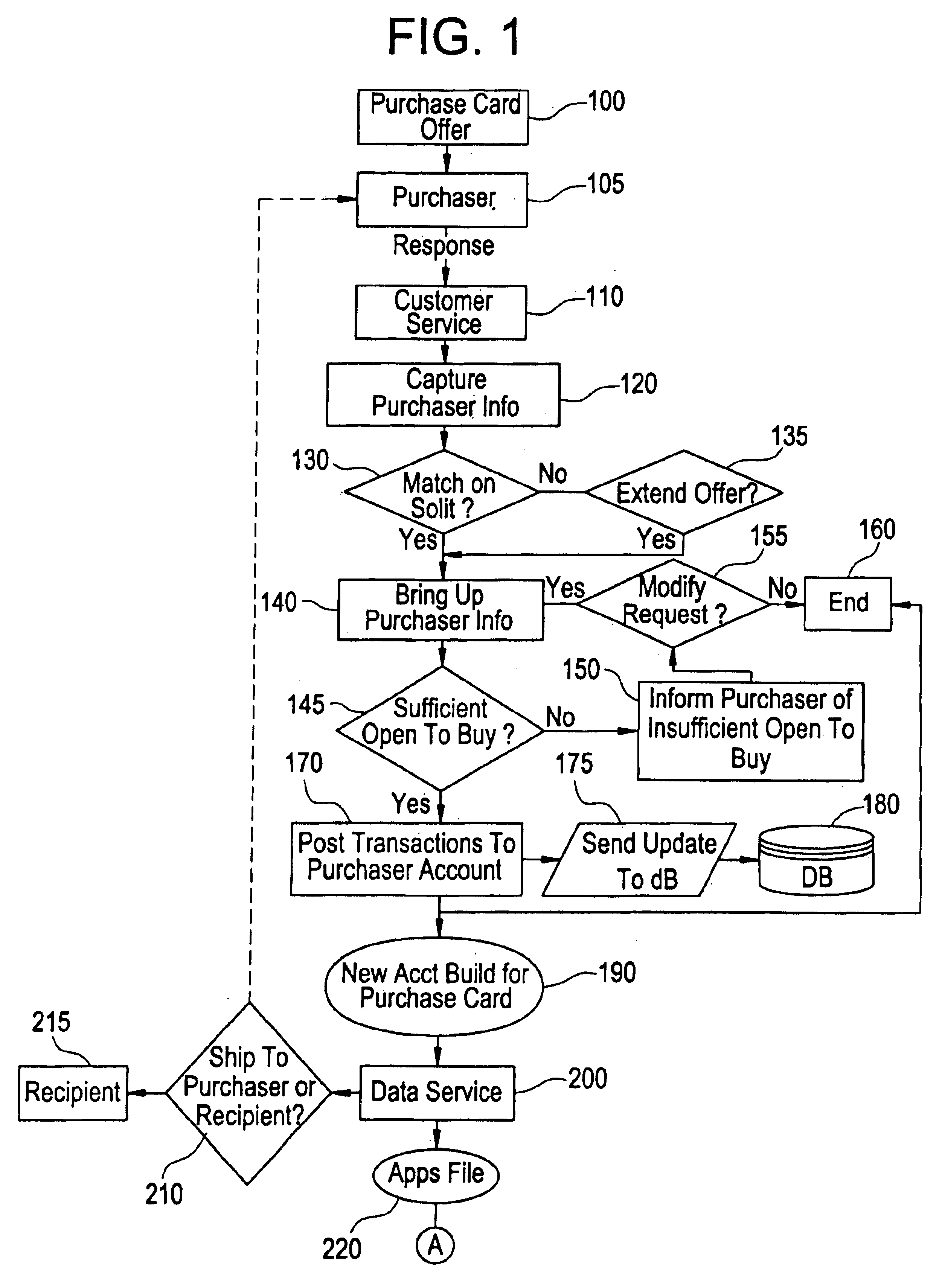

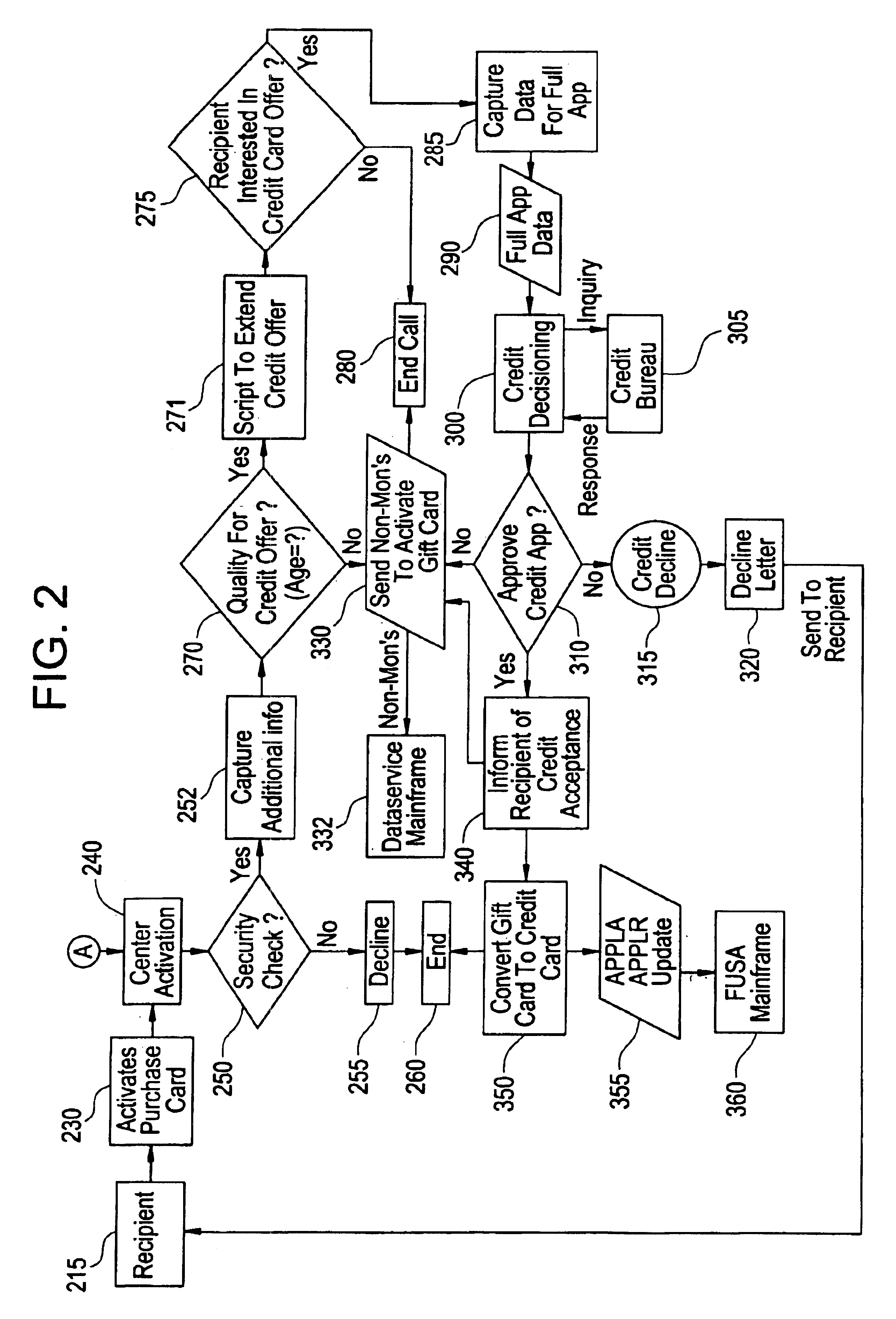

Debit purchasing of stored value card for use by and/or delivery to others

Owner:JPMORGAN CHASE BANK NA

System and method for securely authorizing and distributing stored-value card data

InactiveUS20050051619A1Special service provision for substationPre-payment schemesComputerized systemBiological activation

A computerized system and method for securely authorizing and distributing stored-value card data over a communications network is provided. The method allows for storing in the database a plurality of records comprising stored-value card data for each stored-value card as well as information identifying a plurality of trusted sources of stored-value card activation requests and / or a plurality of trusted communications networks for transmitting stored-value card activation requests. A transmitting step allows for a requesting terminal to transmit over a communications network a request to change the status of a stored-value card. The central processor then determines whether the requesting terminal and / or the communications network is a trusted source. Based on whether the requesting terminal or communications network is a trusted source or trusted communications network, the request can be processed and the card can be activated. A method for establishing a list of trusted sources and trusted communications networks is also provided.

Owner:E2INTERACTIVE INC D B A E2INTERACTIVE

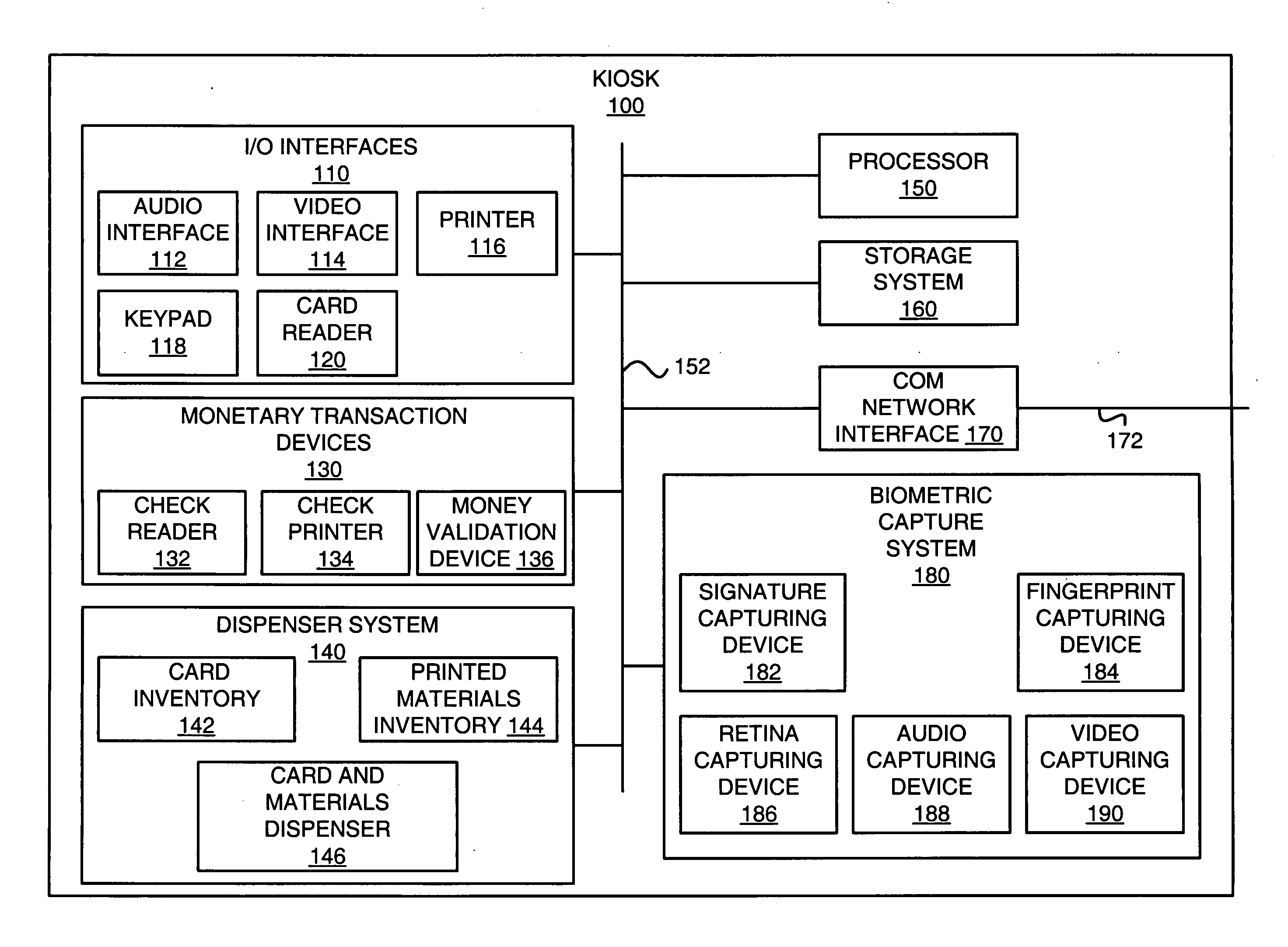

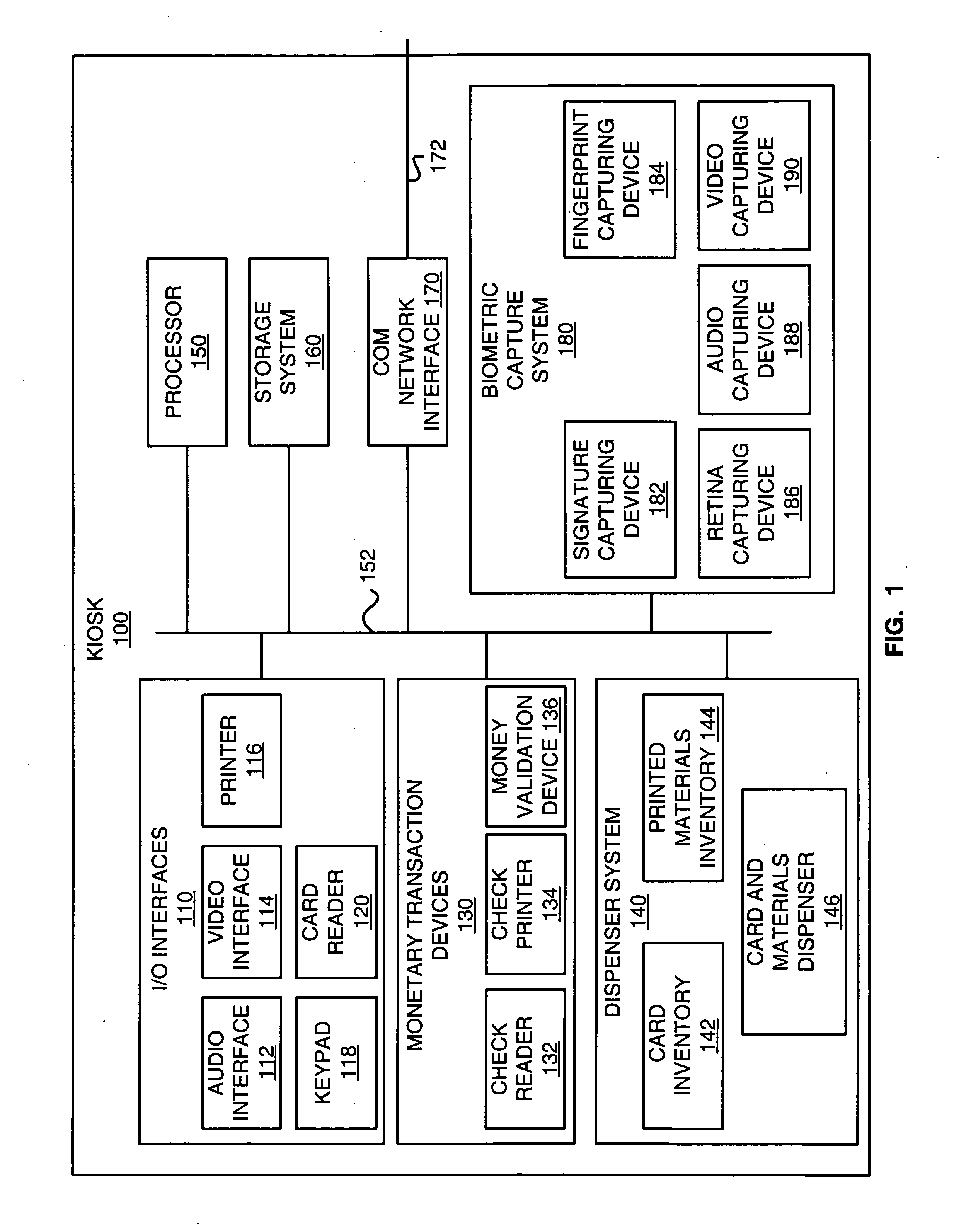

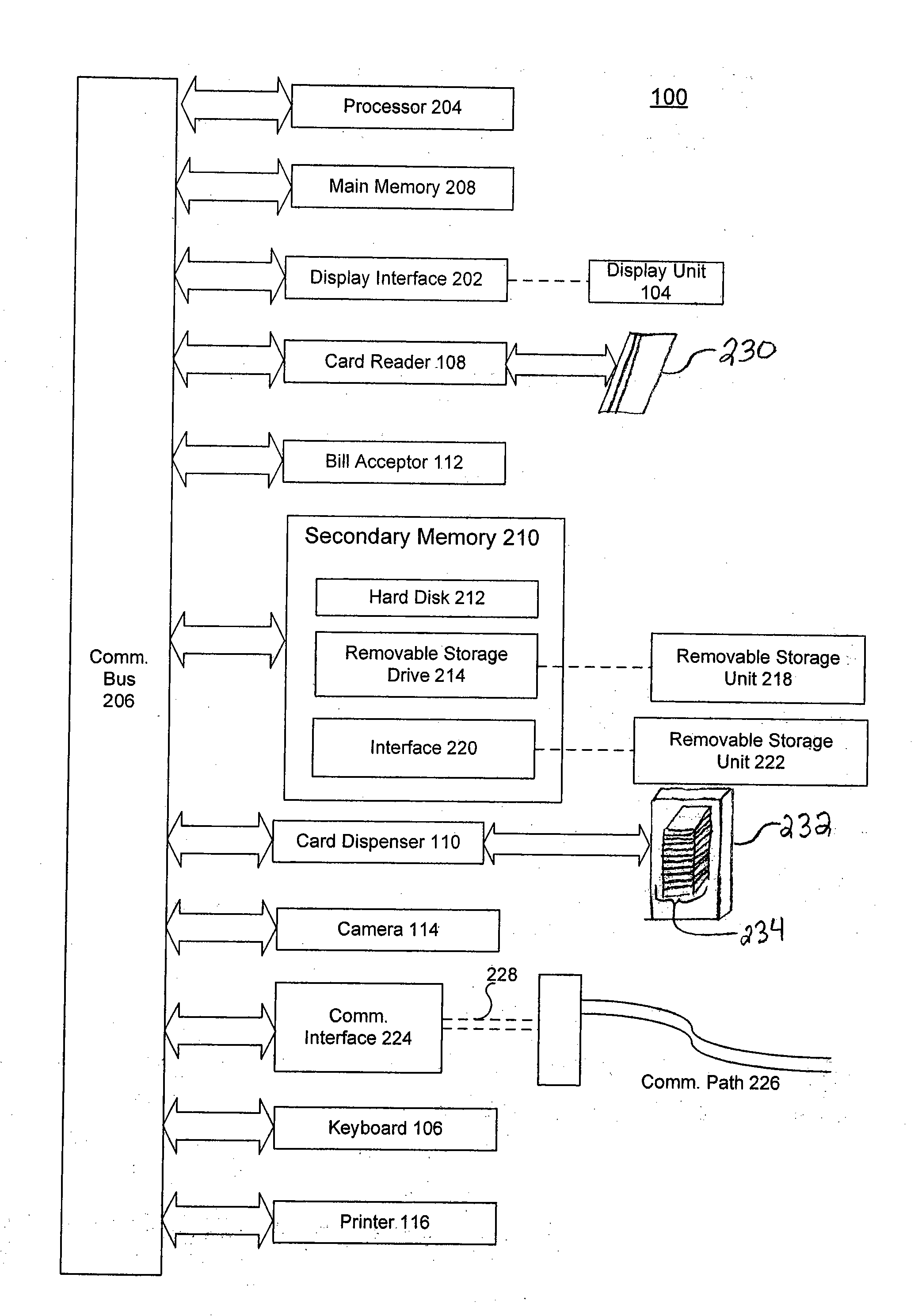

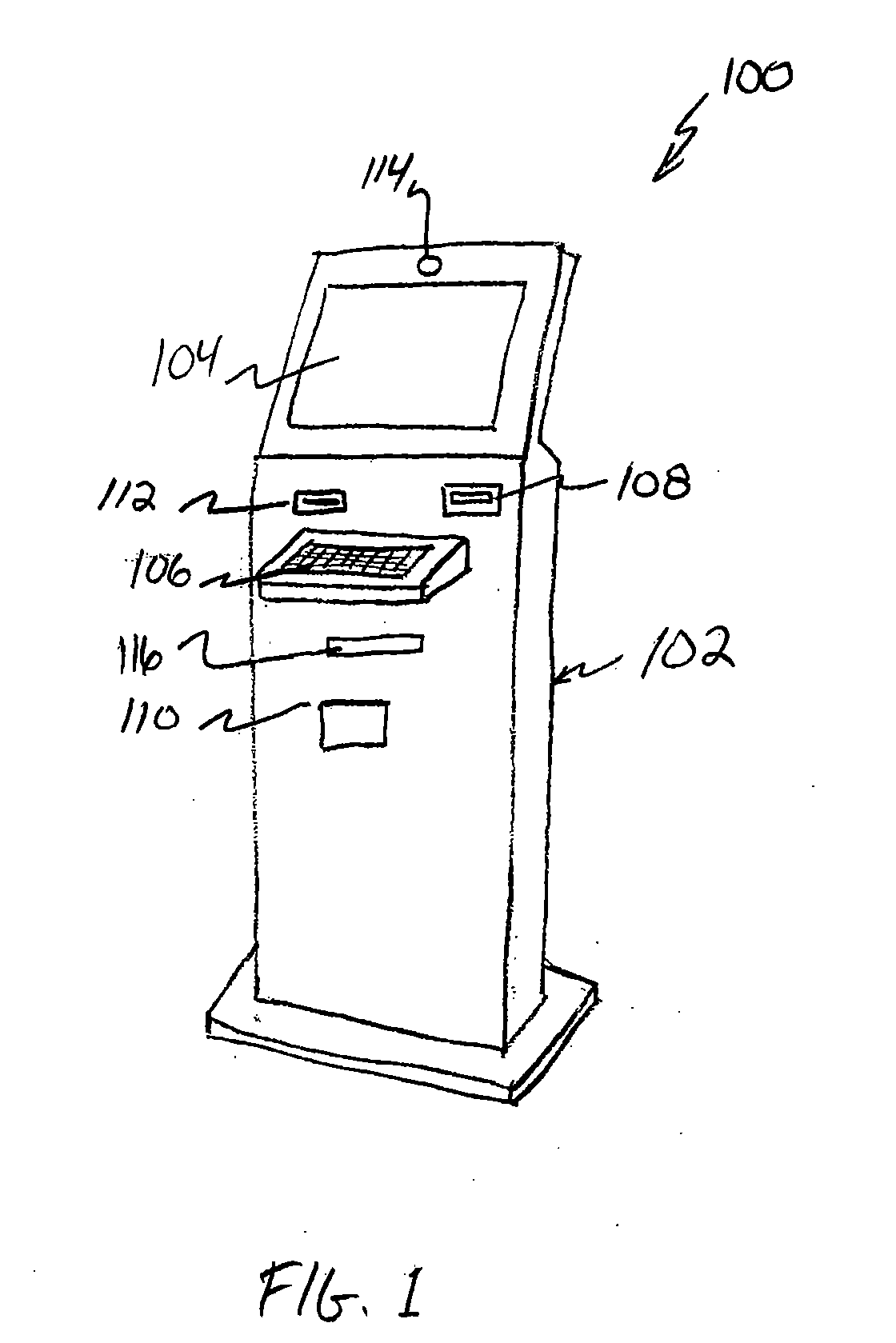

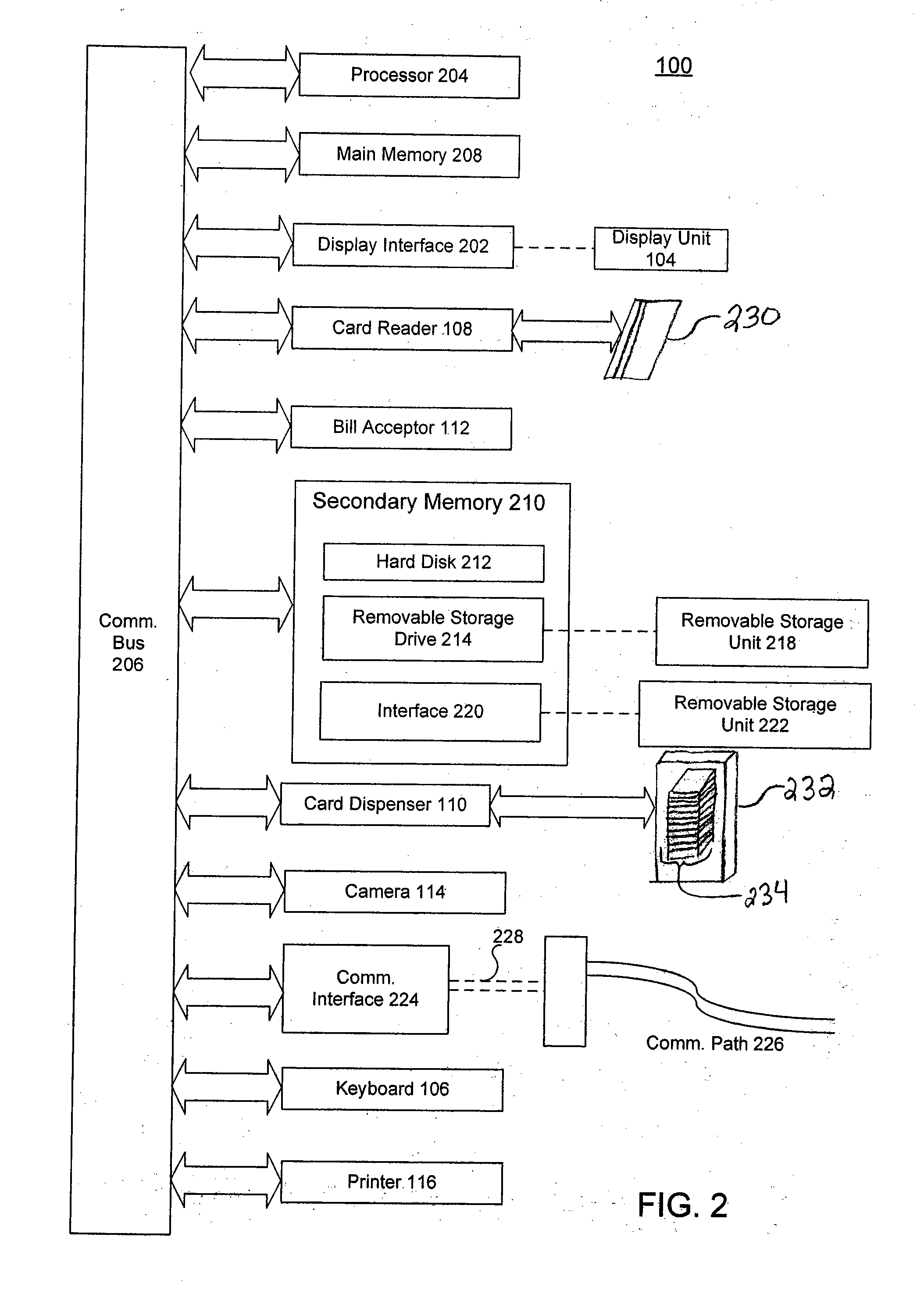

Kiosk and Method for Vending Stored Value Cards

InactiveUS20070272743A1Positive experienceShorten transaction timeComplete banking machinesApparatus for meter-controlled dispensingCredit cardInput selection

A kiosk machine vends stored value cards (i.e., pre-paid and gift cards). The kiosk is self-service and will allow a user to select, purchase and pay for a stored value card without requiring the presence or assistance of a sales clerk. The kiosk can vend one or more cards in a single transaction. The kiosk is a computer-based vending machine having a touch-sensitive video screen and a card reader. The touch screen provides a user interface for a user to receive information and provide input selections. The card reader can be used to read a transaction card (e.g., an American Express card or credit card) to facilitate payment for the stored value card(s) being purchased. The vending method comprises: providing a kiosk having a user interface; receiving, via the user interface, a request to purchase a stored value card, receiving payment for the purchase; determining a card number associated with a selected card; activating the selected card to produce an activated stored value card in the card denomination; and dispensing the activated stored value card. A user purchasing a stored value card can select a type of stored value card, wherein the type is selected from the group consisting of an open card and a closed card. The closed card can be of the type usable only in a shopping center where the kiosk is physically located. The user can further select a card denomination. The method further allows a user to check a card balance for a stored value card.

Owner:LIBERTY PEAK VENTURES LLC

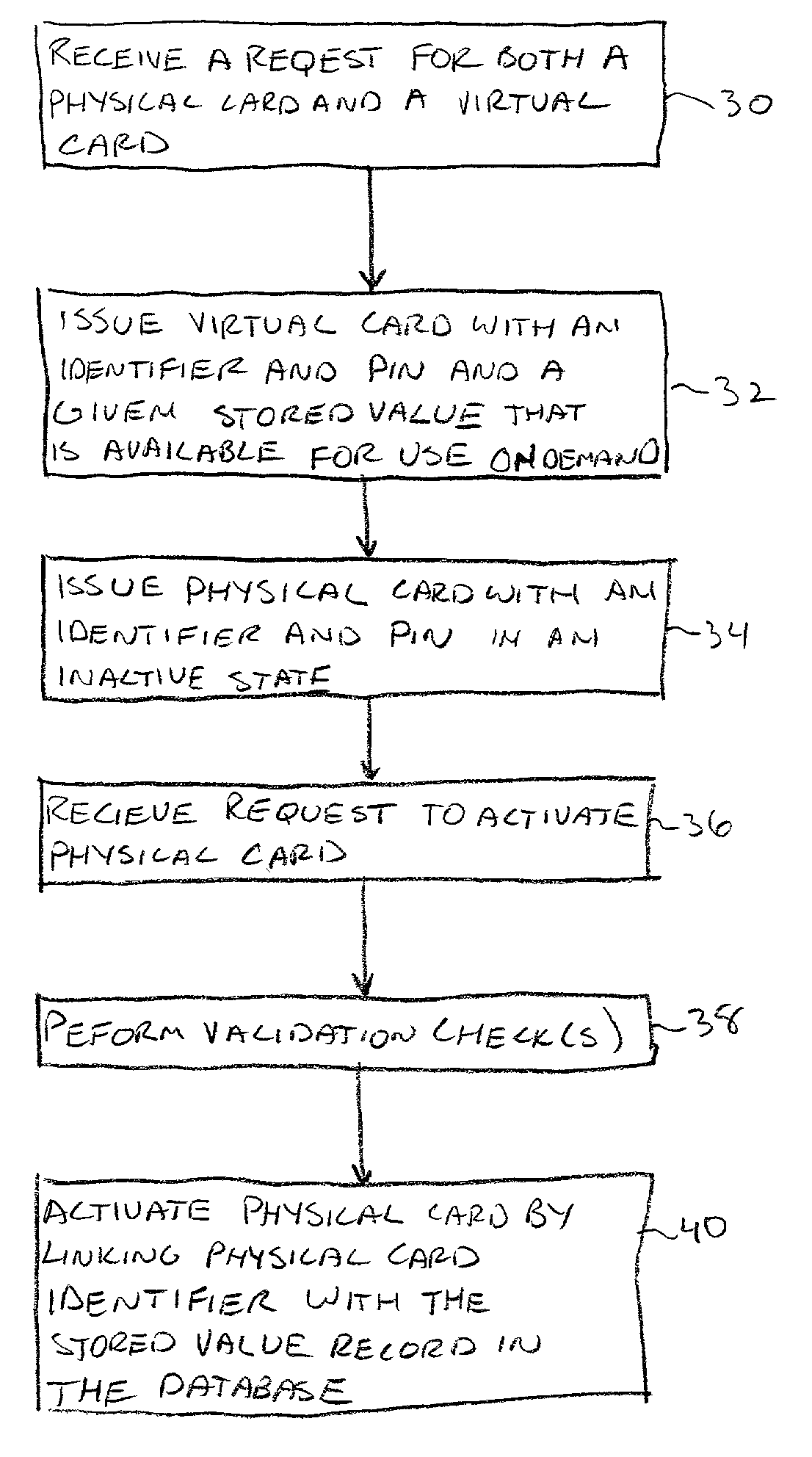

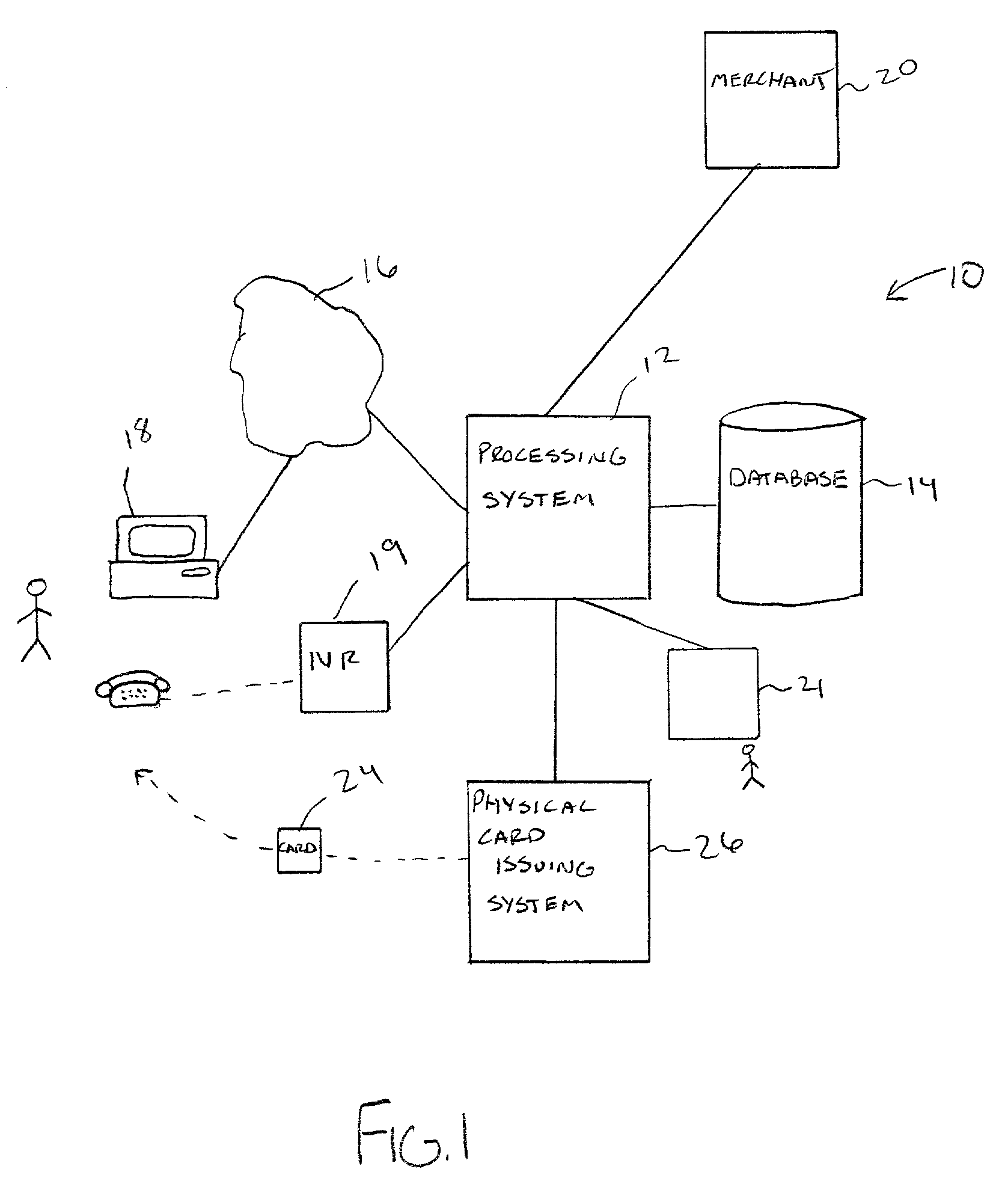

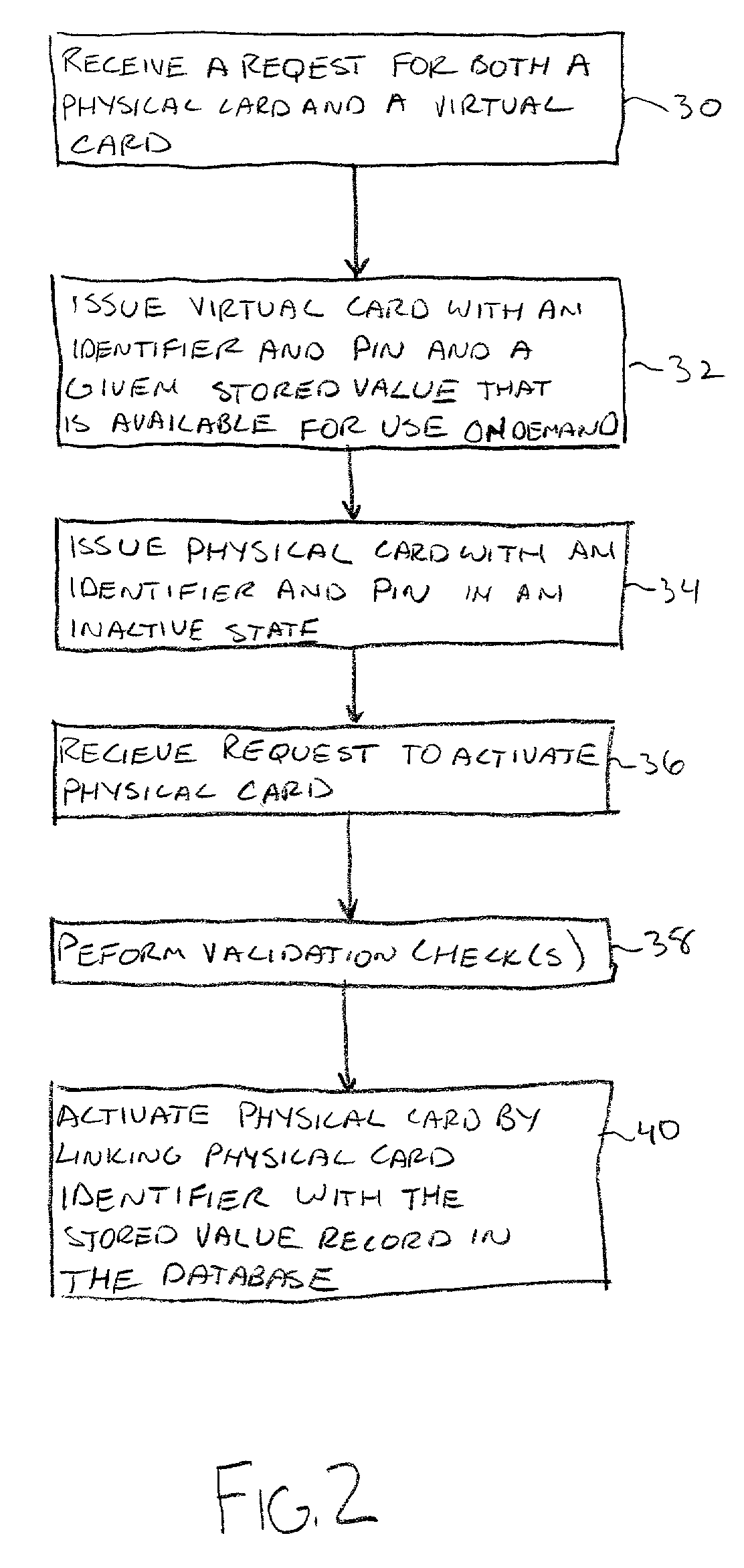

Stored value cards and methods for their issuance

InactiveUS7054842B2Low costCredit registering devices actuationFinanceComputer hardwareStored-value card

A method for issuing both a virtual card and a physical card to a cardholder comprises issuing a virl card to a cardholder, with the virtual card comprising an identifier and an associated database record of a stored value. A physical card is also issued to the cardholder. The physical card includes an identifier that is different from the virtual card identifier, and the physical card is in an inactive state until the physical card is activated by linking of the physical card identifier to the database record of the stored value.

Owner:FIRST DATA +1

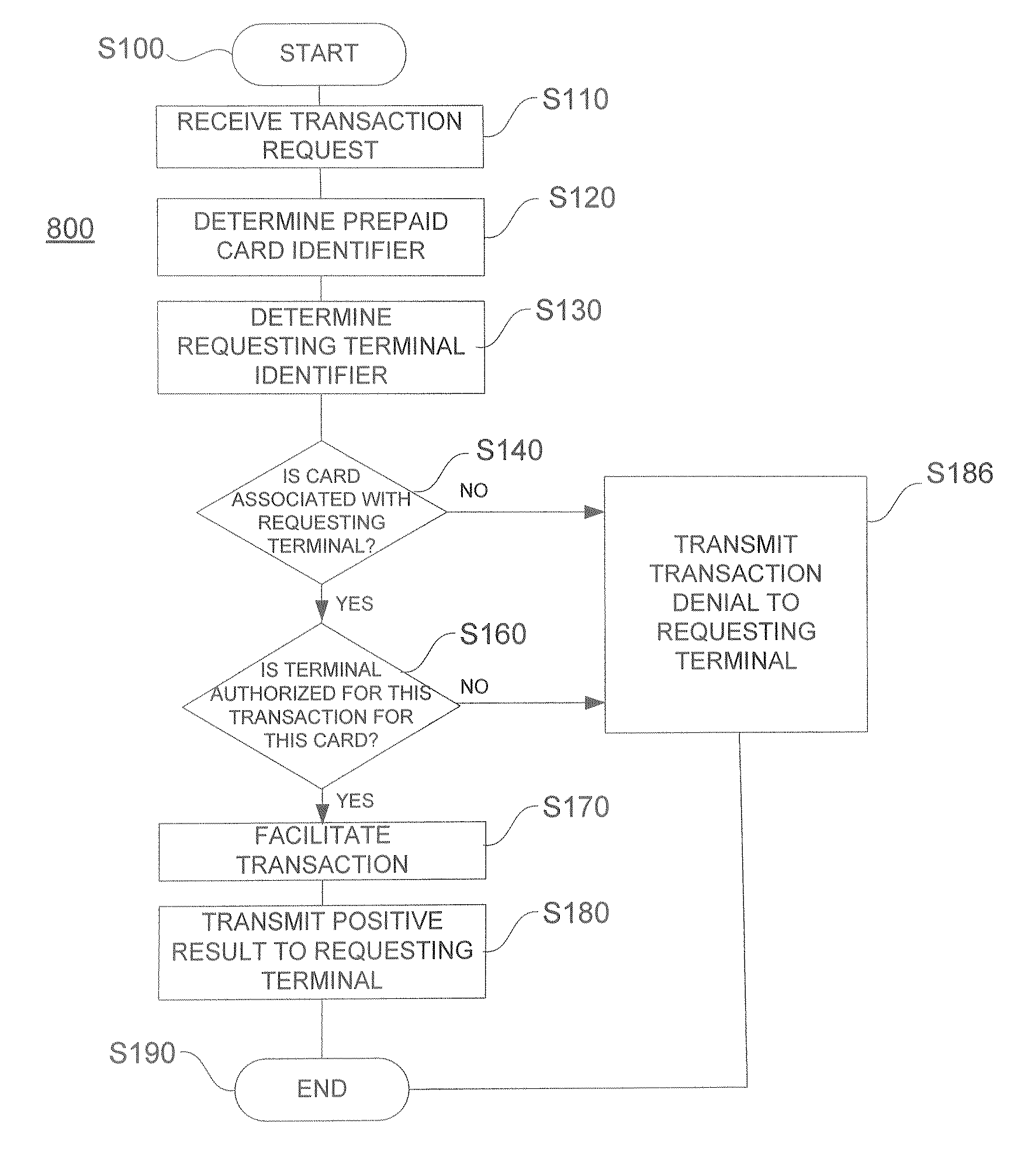

System and Method For Authorizing Stored Value Card Transactions

A computer-implemented method for processing a stored-value card transaction request in a card data management system is presented. The management system has a central processor in communication with one or more point-of-sale terminals over a communications network. Each terminal has a unique terminal identifier and is associated with a location and a prepaid card merchant. The central processor is in communication with a database having stored therein a plurality of card records. Each of these card records contains data associated with a stored-value card distributed to a prepaid card merchant for further distribution to purchasers at a location controlled by the prepaid card merchant. The transaction request comprises a requesting terminal identifier, a card identifier assigned to a stored value card, and information indicative of a requested transaction type. The method further comprises determining if the requesting terminal is authorized to request the requested transaction type for the stored value card.

Owner:E2INTERACTIVE INC D B A E2INTERACTIVE

Methods and Systems For Making a Payment Via a Stored Value Card in a Mobile Environment

InactiveUS20120265677A1Unprecedented convenienceUnprecedented flexibilityFinanceBilling/invoicingFinancial transactionMobile context

Methods and systems for making a financial payment to a payee via a stored value (SV) card utilizing a mobile device such as a mobile telephone (cellphone) or wireless connected personal digital assistant (PDA). The mobile device communicates wirelessly with a mobile financial transaction system (MFTS) that stores user information and transaction information. A user enters information via the mobile device identifying a payee and indicating a stored value card payment method. The mobile device generates a mobile payment instruction that includes information corresponding to the identified payee and indicating a stored value card payment method. The mobile payment instruction is wirelessly communicated to the MFTS. The MFTS generates an MFTS payment instruction to a payment instruction recipient that can issue a new stored value card and / or reload funds onto a pre-existing stored value card. The MFTS communicates the MFTS payment instruction to the payment instruction recipient.

Owner:QUALCOMM INC

Method and system of detecting fraud and incremental commitment of value

InactiveUS20060213979A1Improved bank processing systemPrevent fraudFinancePayment architectureOperating systemStored-value card

Owner:BLUKO INFORMATION GROUP

Method and apparatus for automatically reloading a stored value card

To facilitate the sale of merchandise using a stored value card (SVC), a method and system are provided to automatically reload an SVC in accordance with automatic reload preferences associated with the SVC account. The preferences include the pre-authorized reload amount, payment method, and the circumstances under which to automatically reload the SVC with the pre-authorized reload amount. The preferences are previously specified by a party associated with the SVC when setting up the automatic reload option. The party is notified when the automatic reload occurs.

Owner:STARBUCKS

System for providing cardless payment

InactiveUS20060173791A1Convenient and easy to rememberConvenient and/orFinancePayment circuitsComputer hardwareThe Internet

The method and system of the invention provide a variety of techniques for using a selected alias and a selected personal identification entry (PIE) in conjunction with use of a transaction card, such as a credit card, debit card or stored value card, for example. A suitable number or other identification parameter is selected by the account-holder as an alias. The account-holder is then required to choose a PIE for security purposes. The alias is linked to the account-holder's credit card number via a database. When the account-holder enters into a transaction with a merchant, the physical card need not be present. The account-holder simply provides his or her alias and then the PIE. This can be done at any point of sale such as a store, catalog telephone order, or over the Internet. The alias and PIE are entered and authorization is returned from the credit card company.

Owner:JPMORGAN CHASE BANK NA

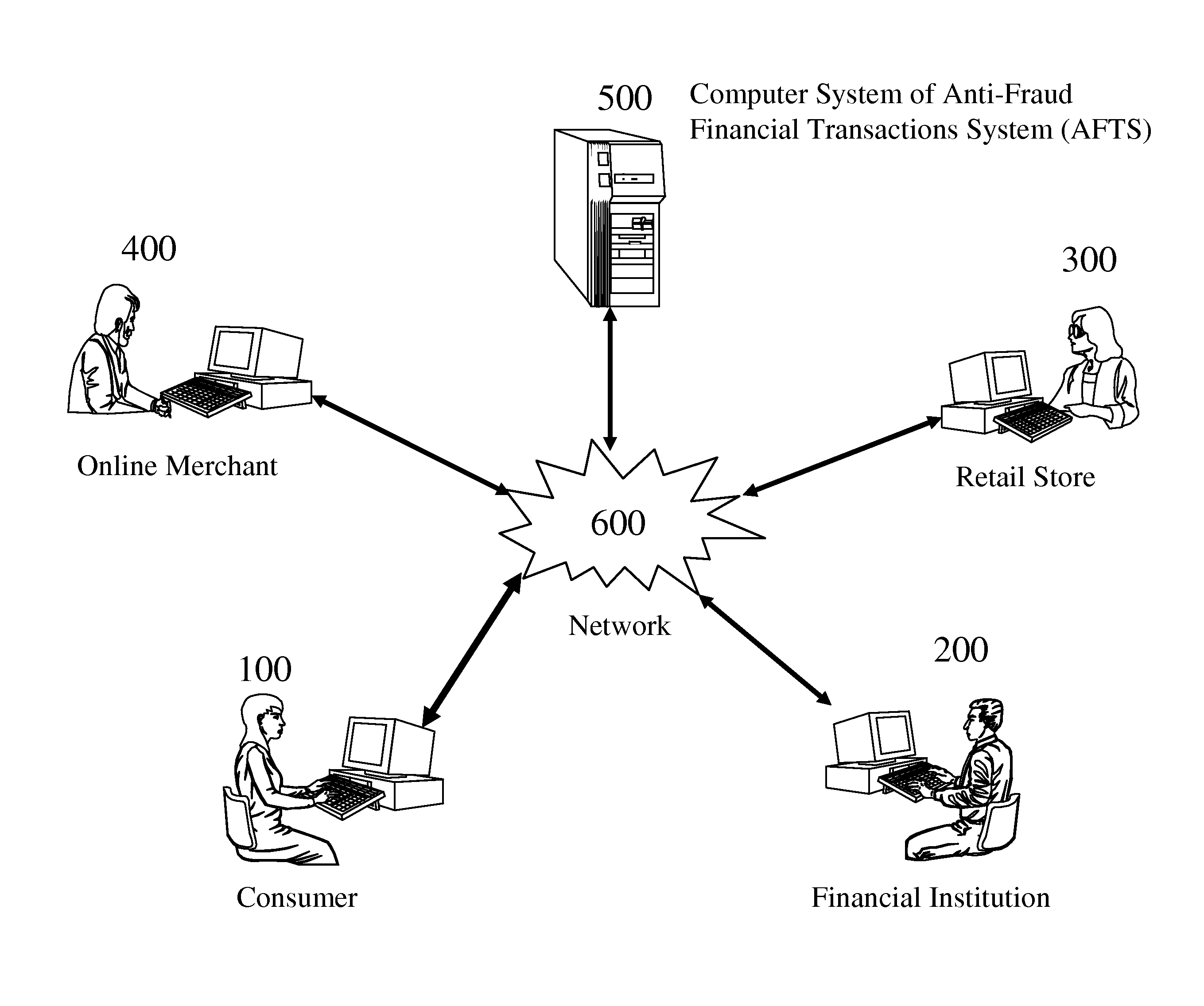

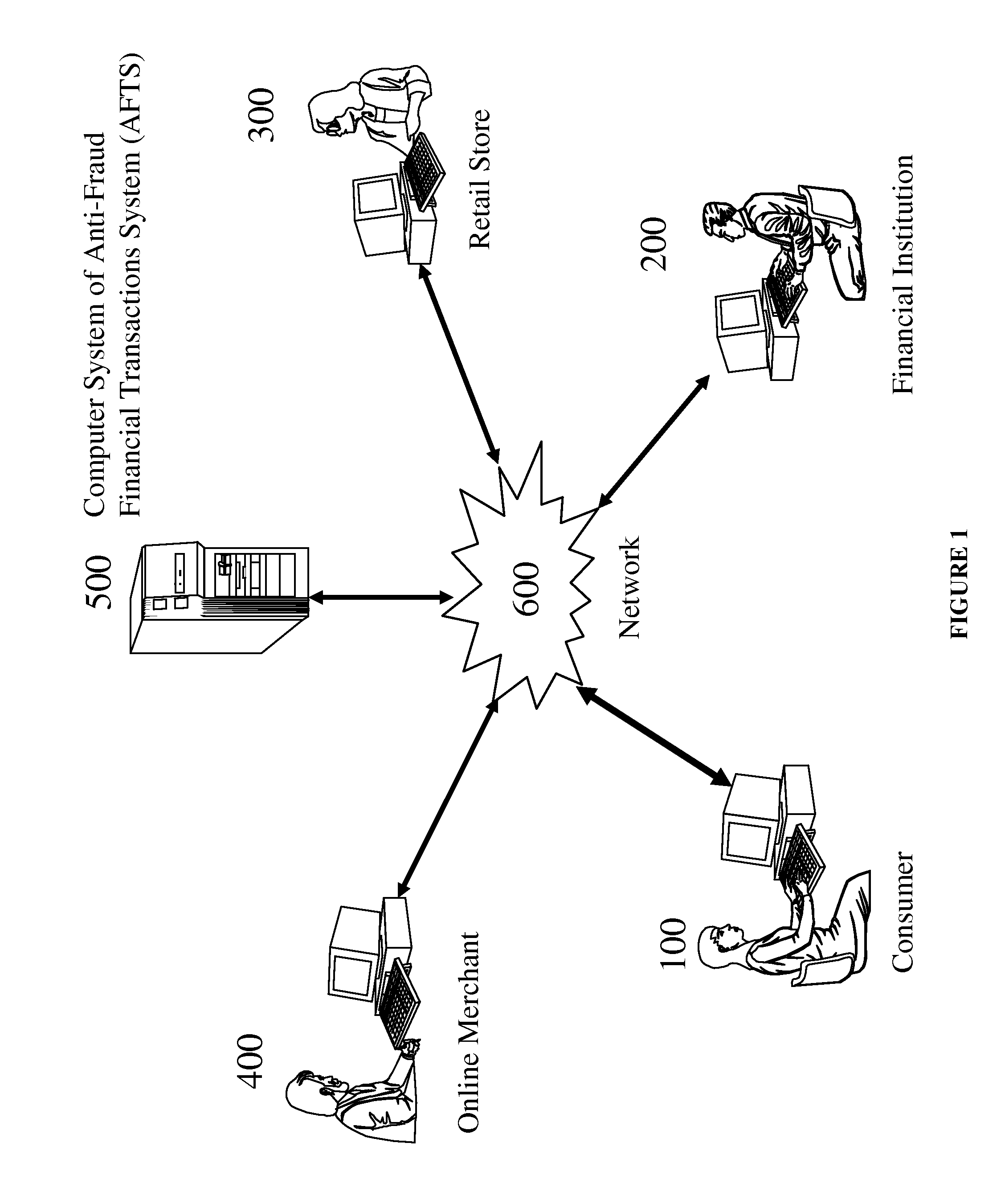

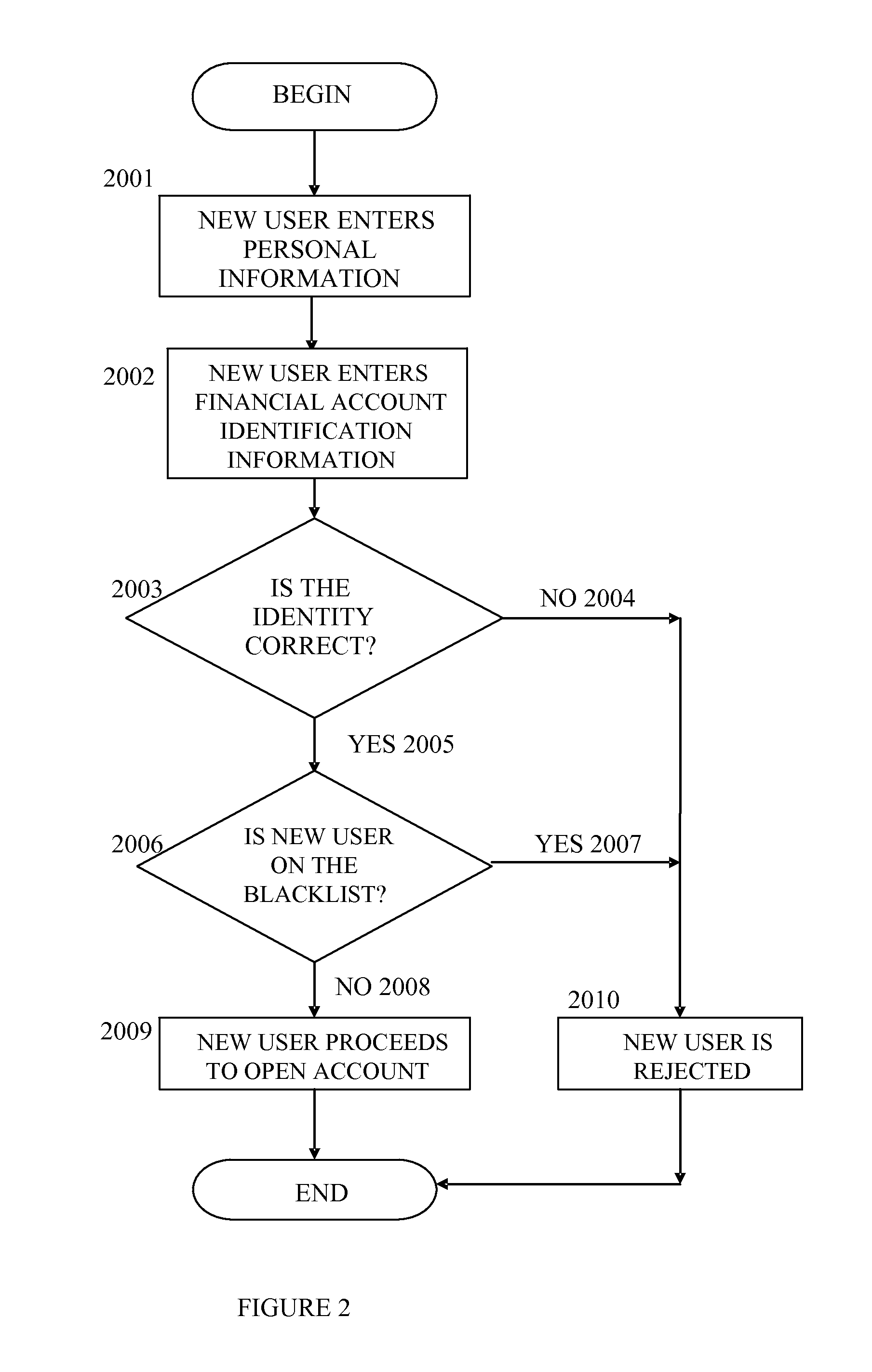

Anti-fraud financial transactions system

ActiveUS20130103482A1Easily fabricatedEasy to be stolenMarketingInternet privacyFinancial transaction

Users can conduct financial transactions in a secure manner without the need to use any traditional financial instrument, such as credit card, debit card, ATM card, gift card, stored value card, prepaid card, cash, check, coupon, token, ticket, voucher, certificate, note, security, etc. In addition, users' identities are kept confidential in the transactions without violating the Anti-Money Laundering and Anti-Terrorist Financing requirements.

Owner:SONG ALEXANDER +2

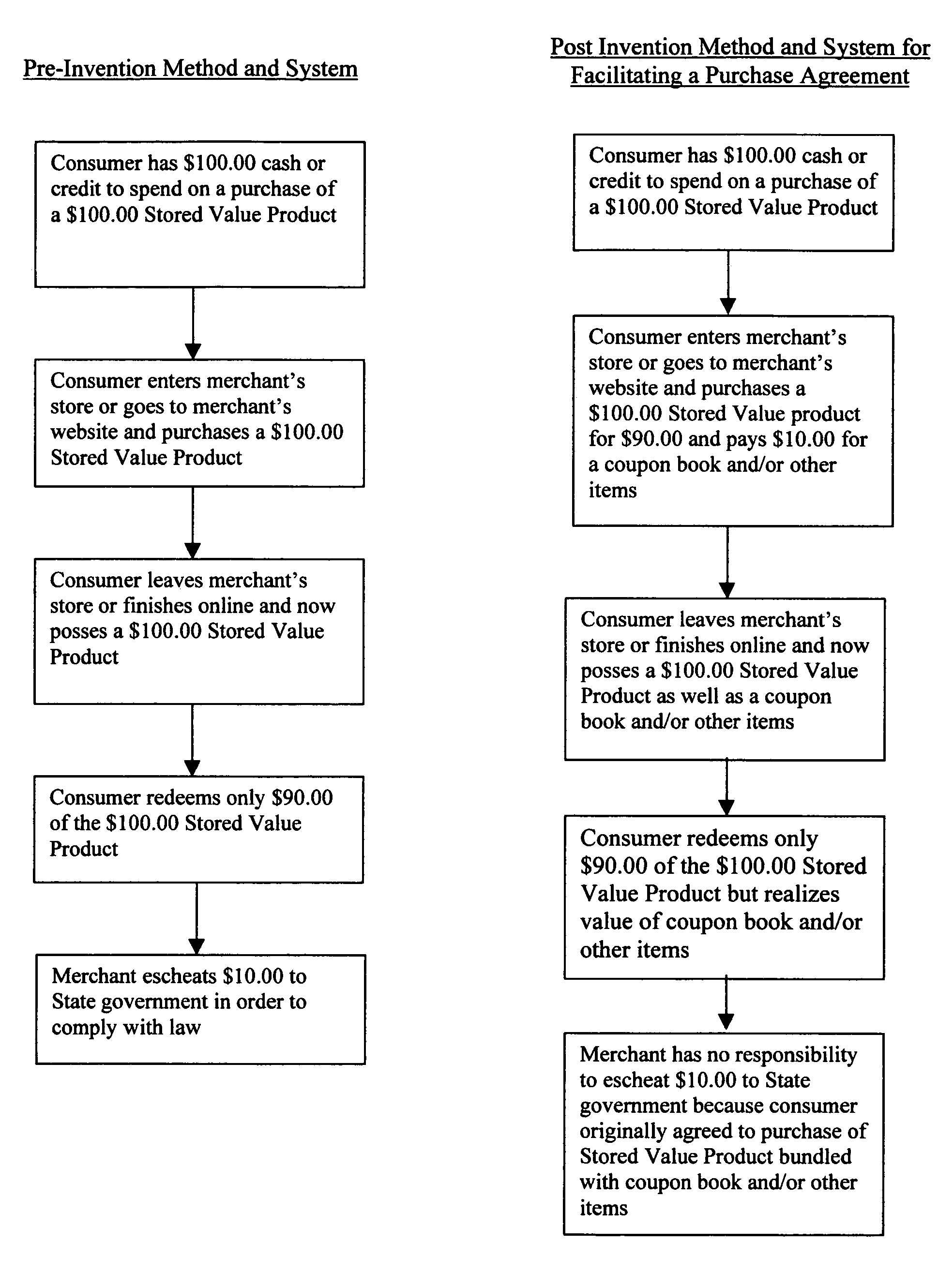

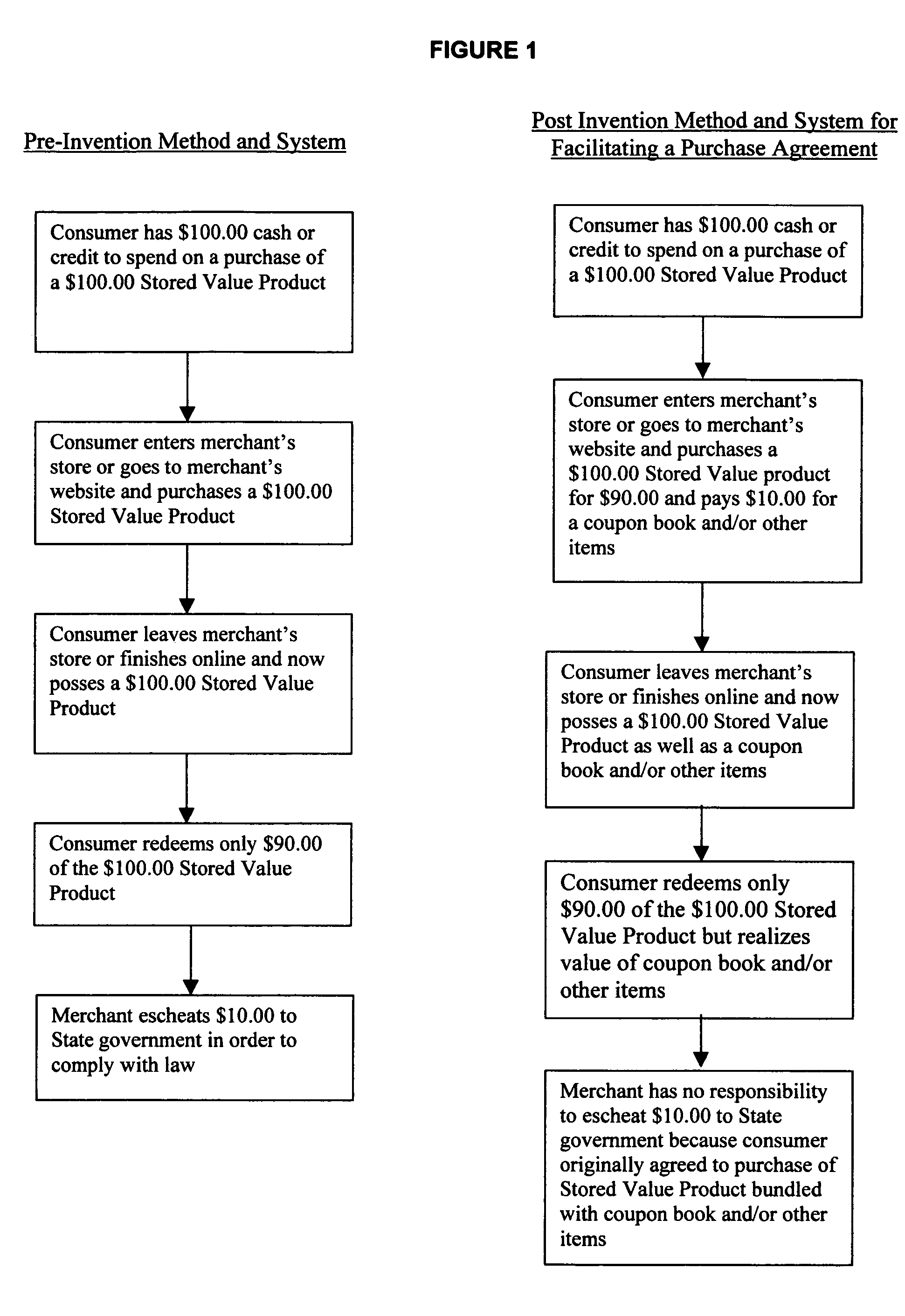

Method and system for facilitating a purchase agreement

The method of the present invention changes the present day “value for value” methodology, system and process for the purchase of Stored Value Card purchases to a “value for greater value” or “value for greater perceived value” methodology, system and process by bundling the actual Stored Value Card product with coupons that would convey a value. The bundling of coupons, vouchers, and etc., with the Stored Value Card allows merchants to charge or allocate a certain fee for the coupon / voucher aspect of the Stored Value Card sale. This in turn allows merchants to transact and / or report and / or account for the sale of Stored Value Cards in a manner that avoids escheatment.

Owner:ONE28 MARKETING GRP

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com