Patents

Literature

74 results about "ATM card" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

An ATM card is any payment card issued by a financial institution to its customers which enables a customer to access an automated teller machine for transactions such as deposits, cash withdrawals, obtaining account information, and other types of banking transactions. The payment card may be any card which has that feature enabled, and may be a debit, credit, a limited-use ATM or other card. Interbank networks allow the use of ATM cards at ATMs of financial institutions other than those of the issuing institution. ATM cards can also be used on improvised ATMs, such as merchants' card terminals that deliver ATM features without any cash drawer. These terminals can also be used as Cashless scrip ATMs by cashing the fund transfer receipt at the merchant's Cashier. The first ATM cards were issued by Barclays in London, in 1967, and by Chemical Bank in Long Island, New York, in 1969.

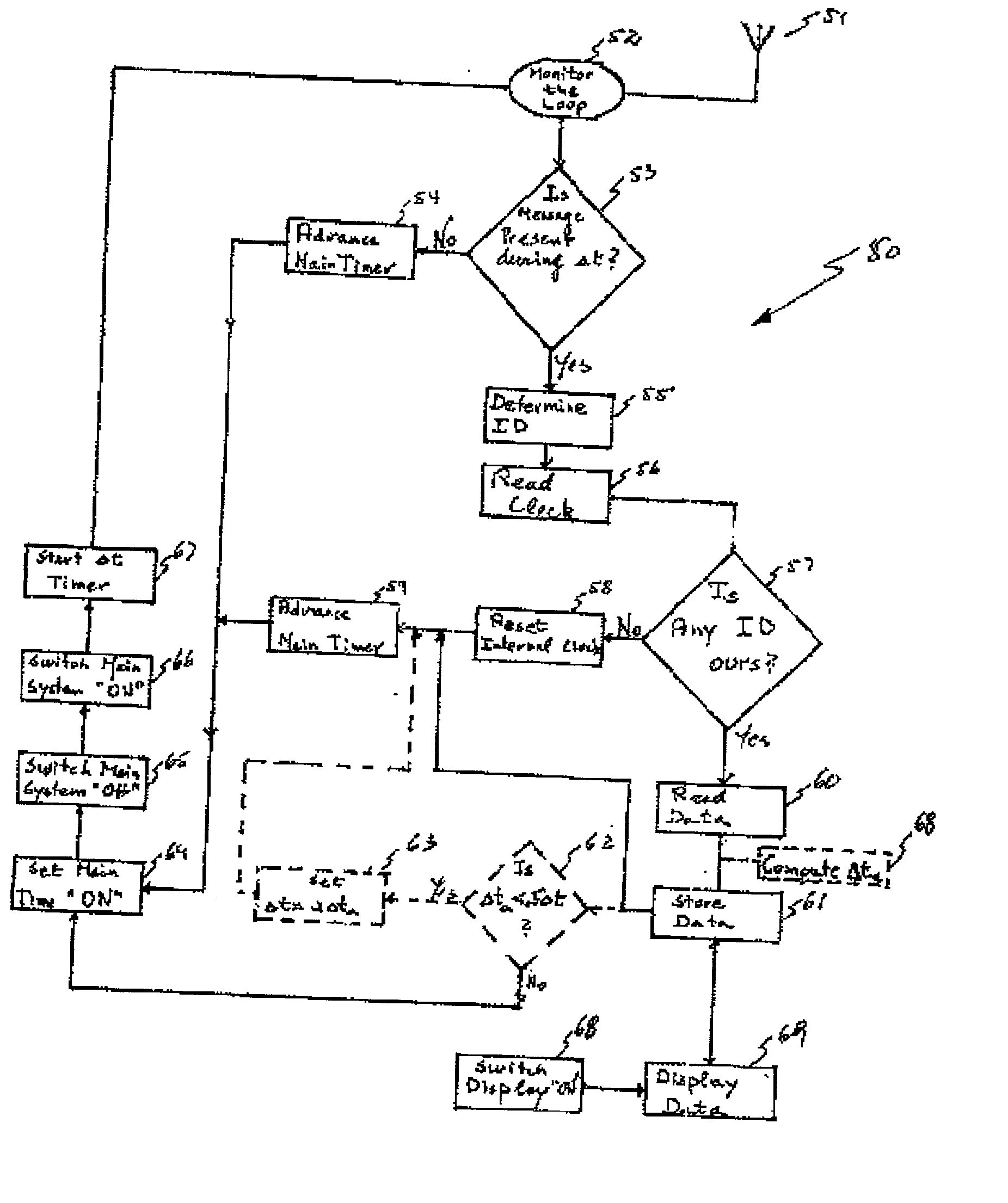

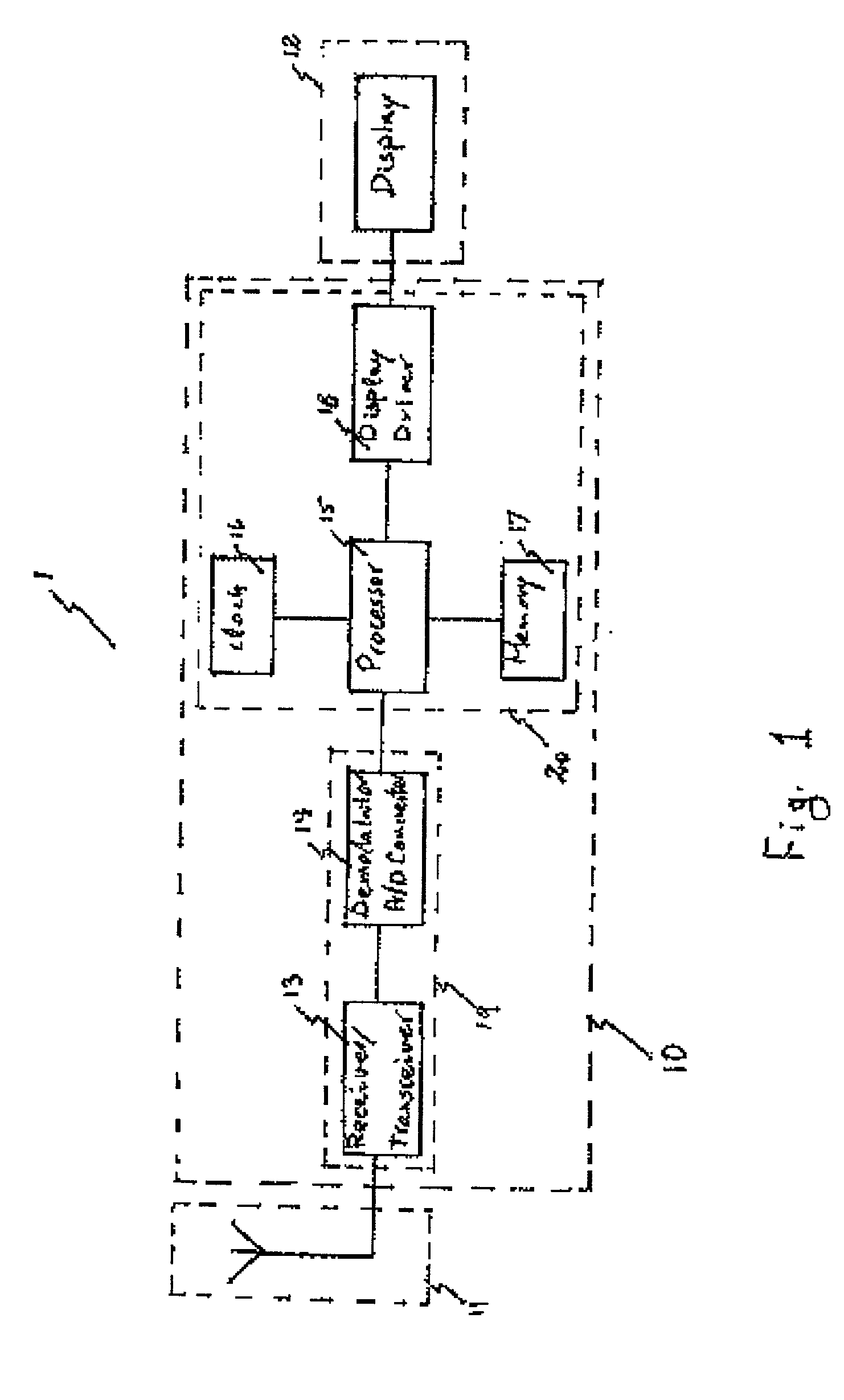

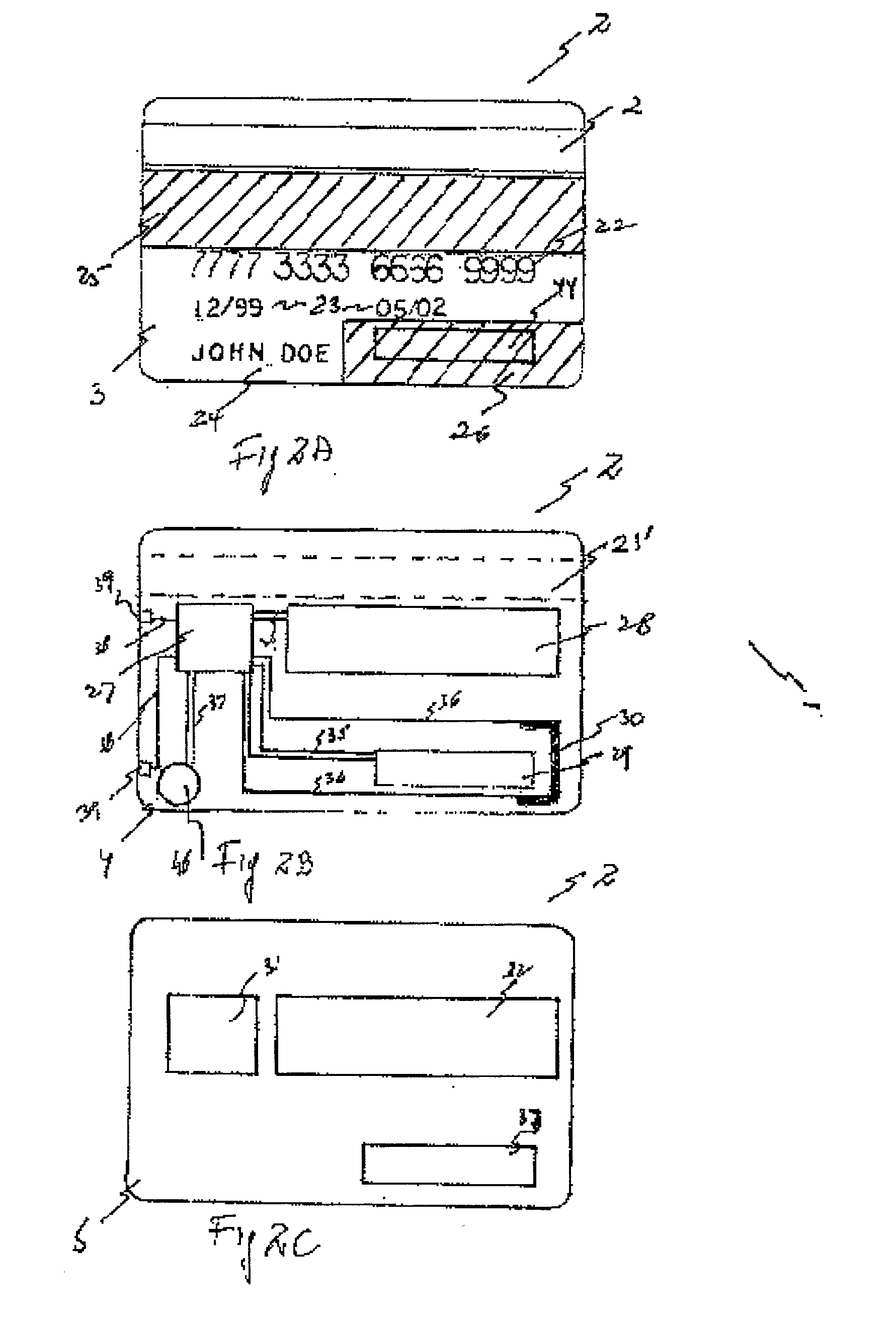

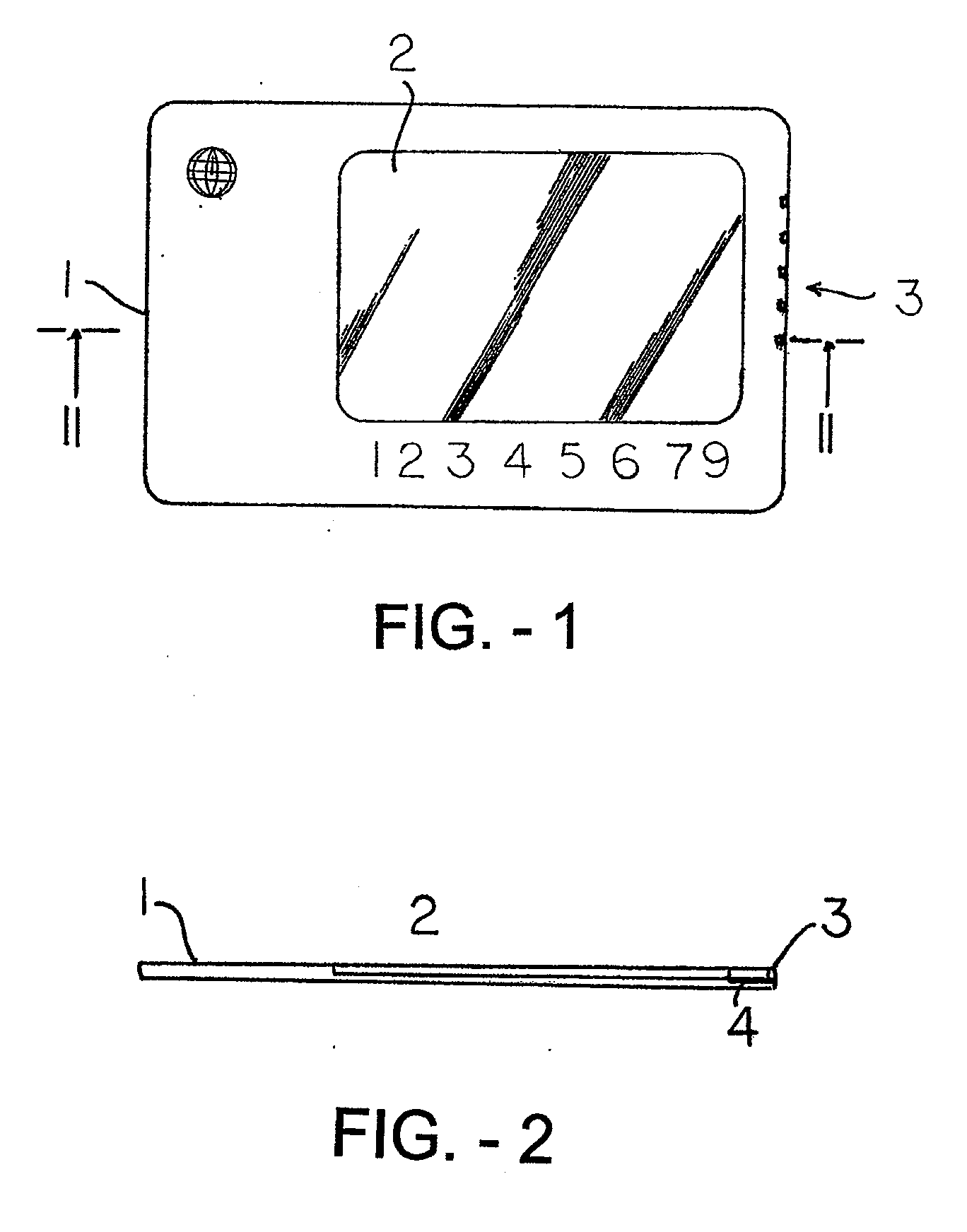

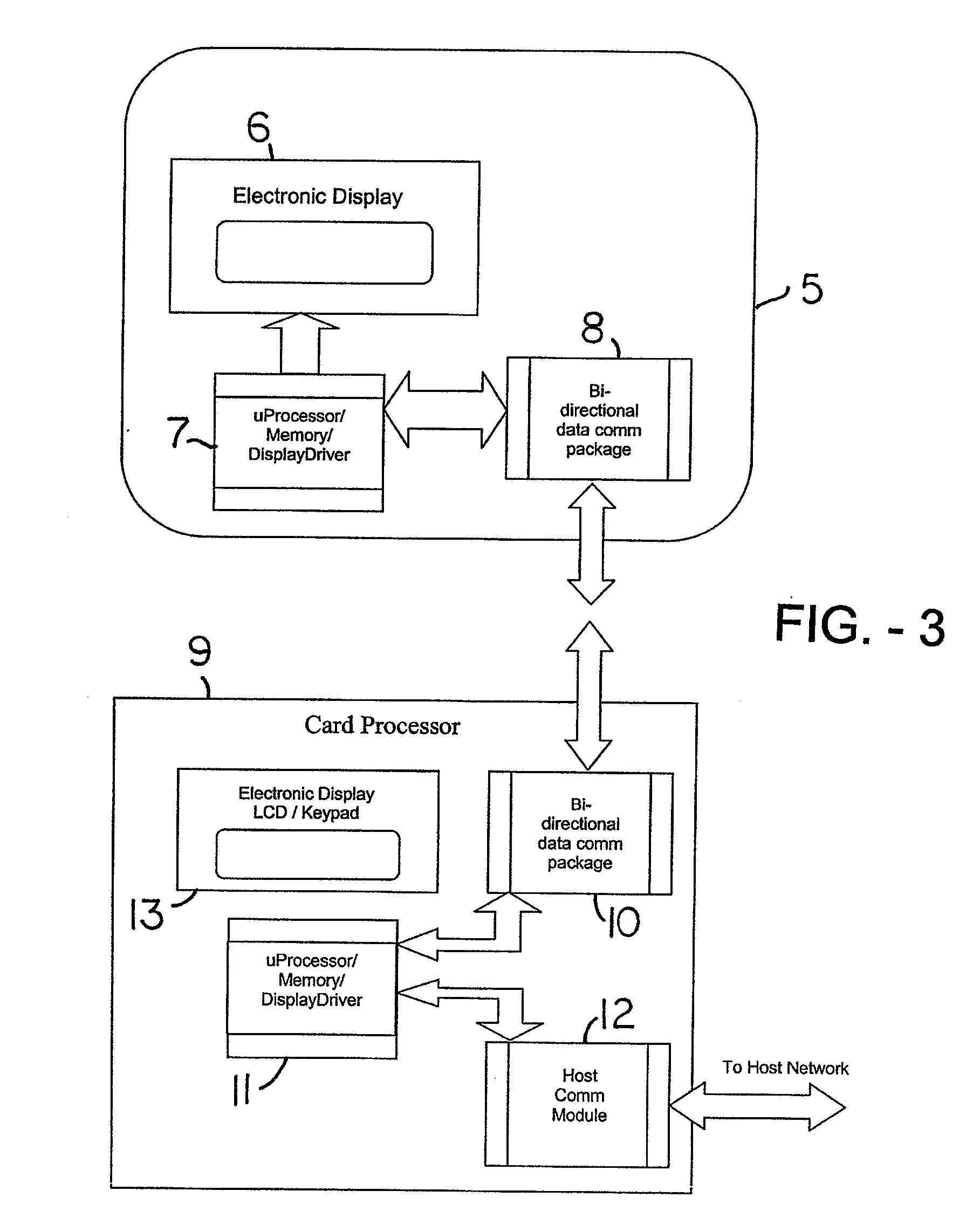

Wireless communicating credit card

InactiveUS20020116330A1Preserve battery lifeGuaranteed timeComplete banking machinesFinanceDisplay deviceComputer science

A financial transmission method utilizes smart cards with radiofrequency communication between the central station and the card so that the smart card is periodically or continuously updated as to account details which can be readily seen by a display on the card. The card, which otherwise has all of the size and dimensions and shape and embossability of a conventional credit card, debit card or ATM card also has the usual magnetic stripe-bearing information as to the card and the account to be debited or modified.

Owner:HED AHARON ZEEV +1

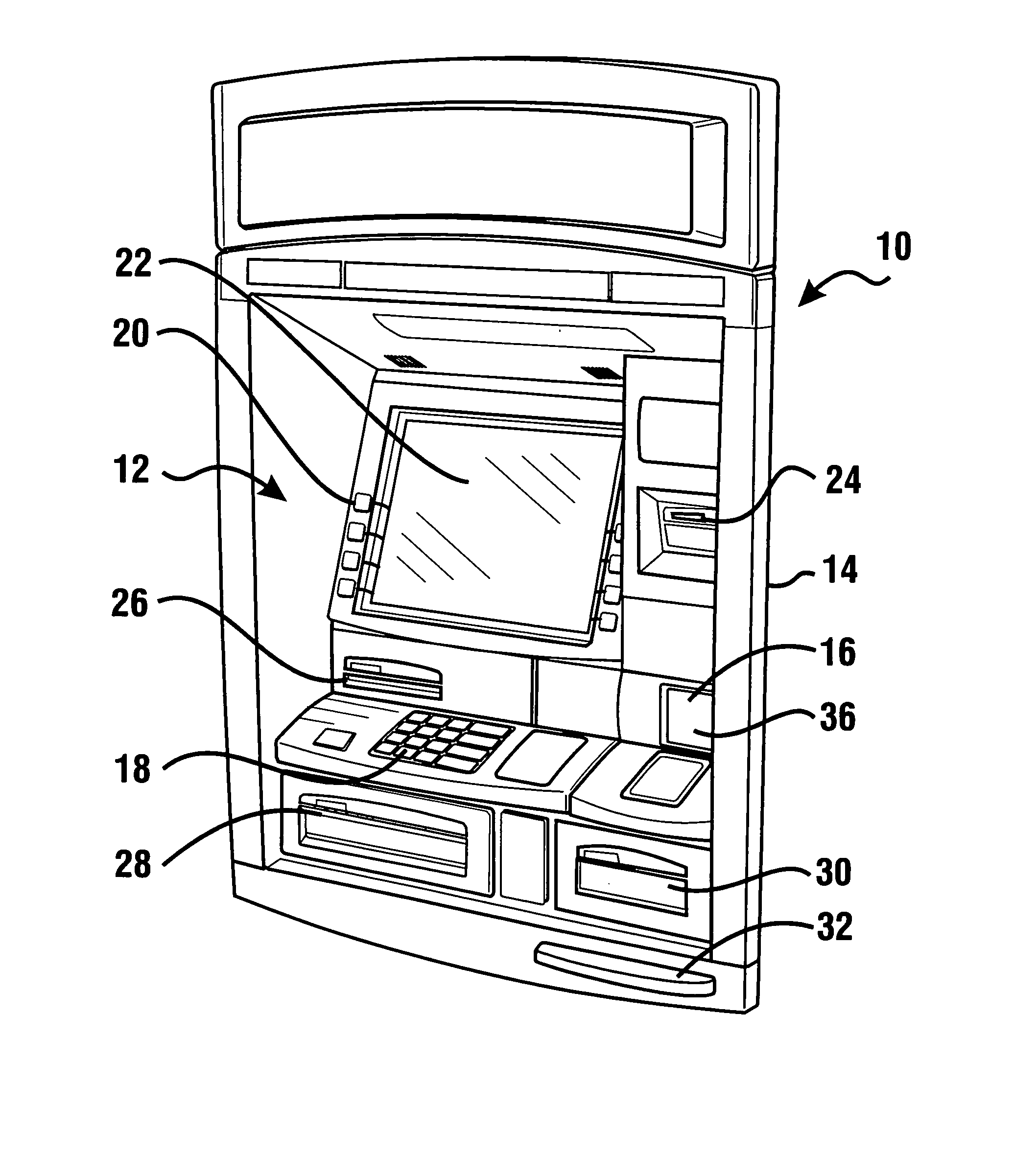

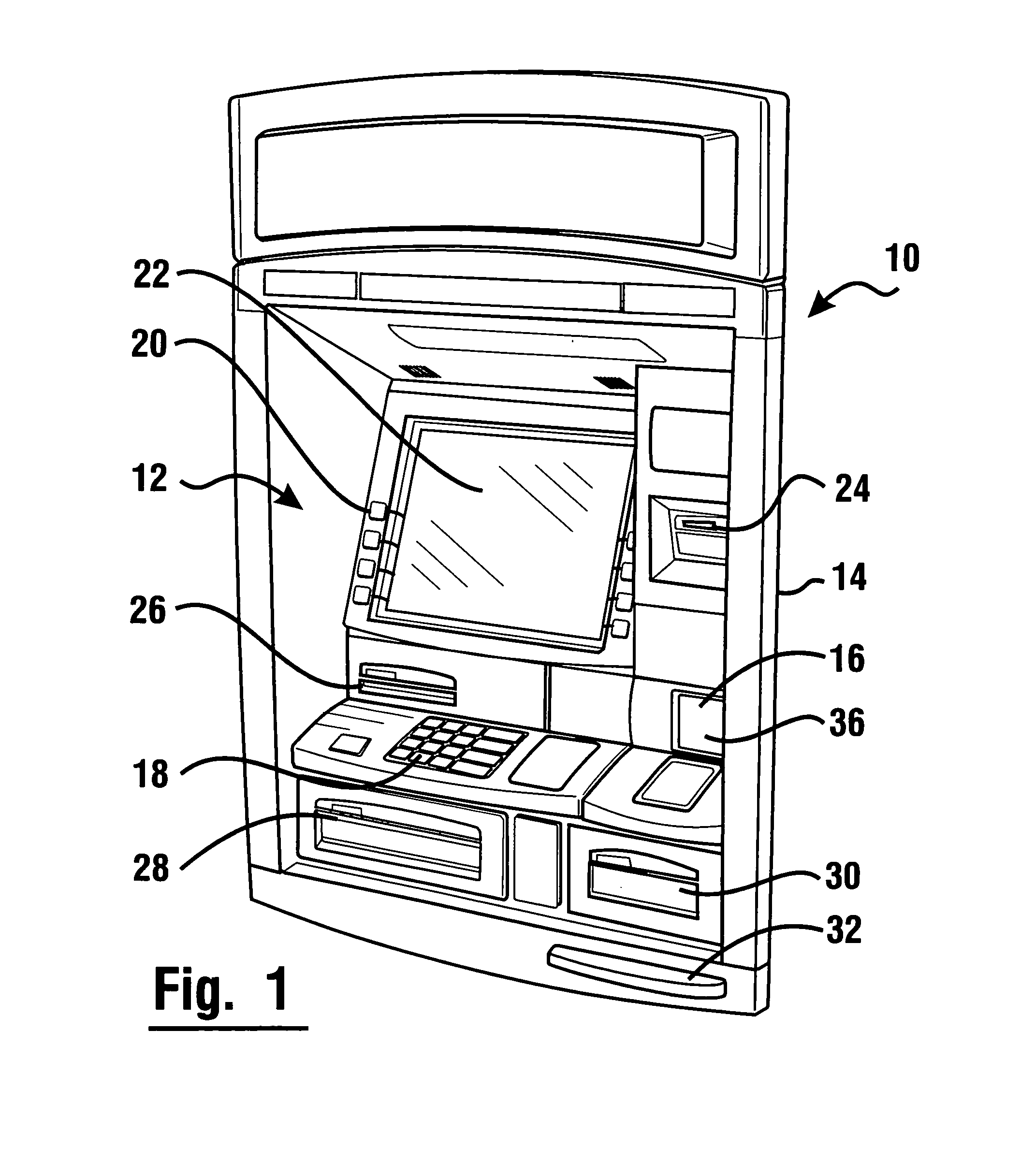

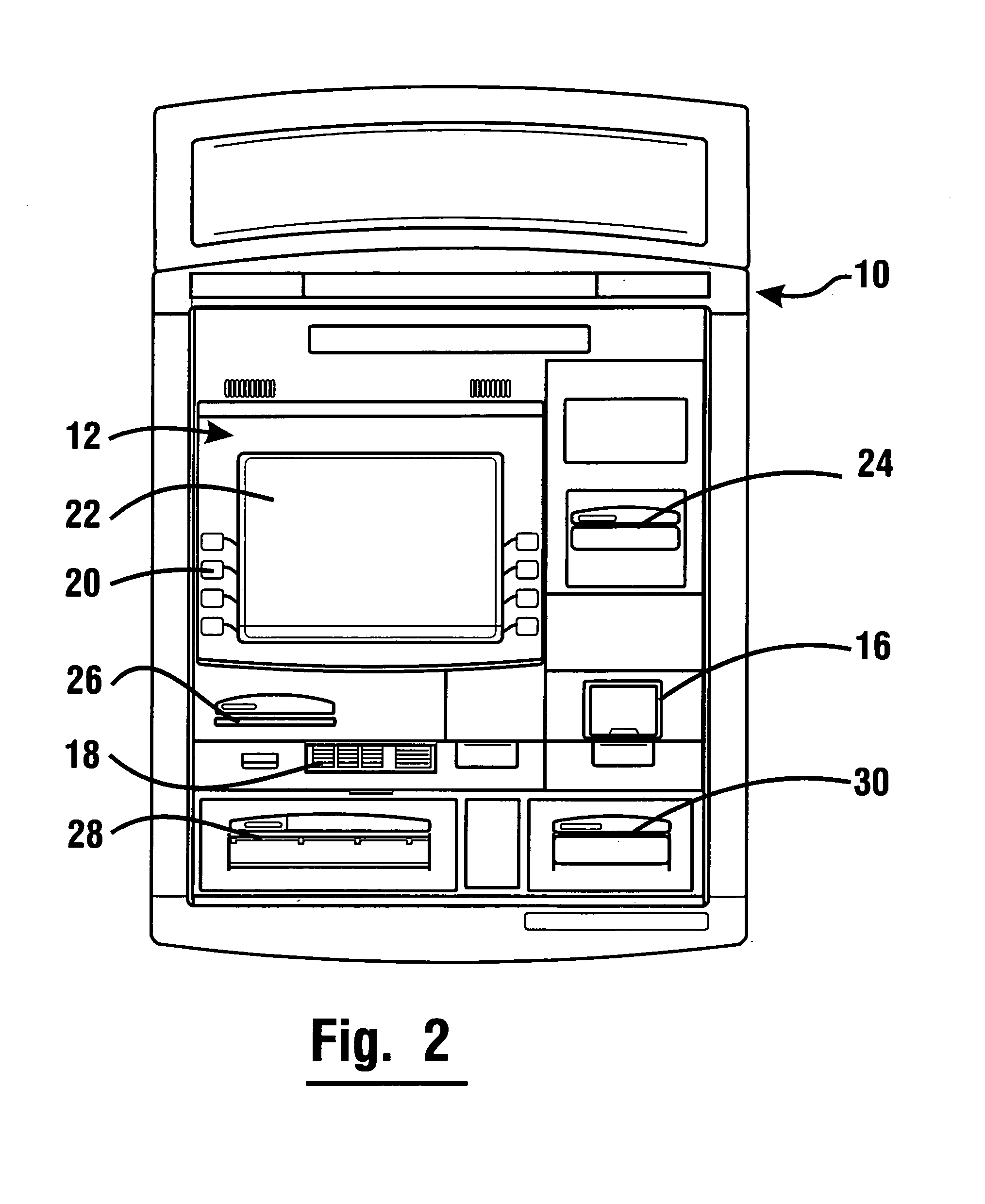

ATM with RFID card, note, and check reading capabilities

ActiveUS7284692B1Reduce security risksService degradationComplete banking machinesFinanceChequeATM card

An ATM with a currency dispenser includes a contactless card reader. The contactless card reader can read data from an RFID tag of a customer's ATM card. The contactless card reader, such as an RFID tag reader, can be located so as to provide additional space for another transaction component. The contactless card reader can also be used in conjunction with a magnetic stripe card reader. The ATM includes a housing for the RFID tag reader that is adapted to prevent interception of radio signals. The ATM is able to prevent dispensing of currency in situations where unauthorized detection of signals is sensed.

Owner:DIEBOLD SELF SERVICE SYST DIV OF DIEBOLD NIXDORF INC

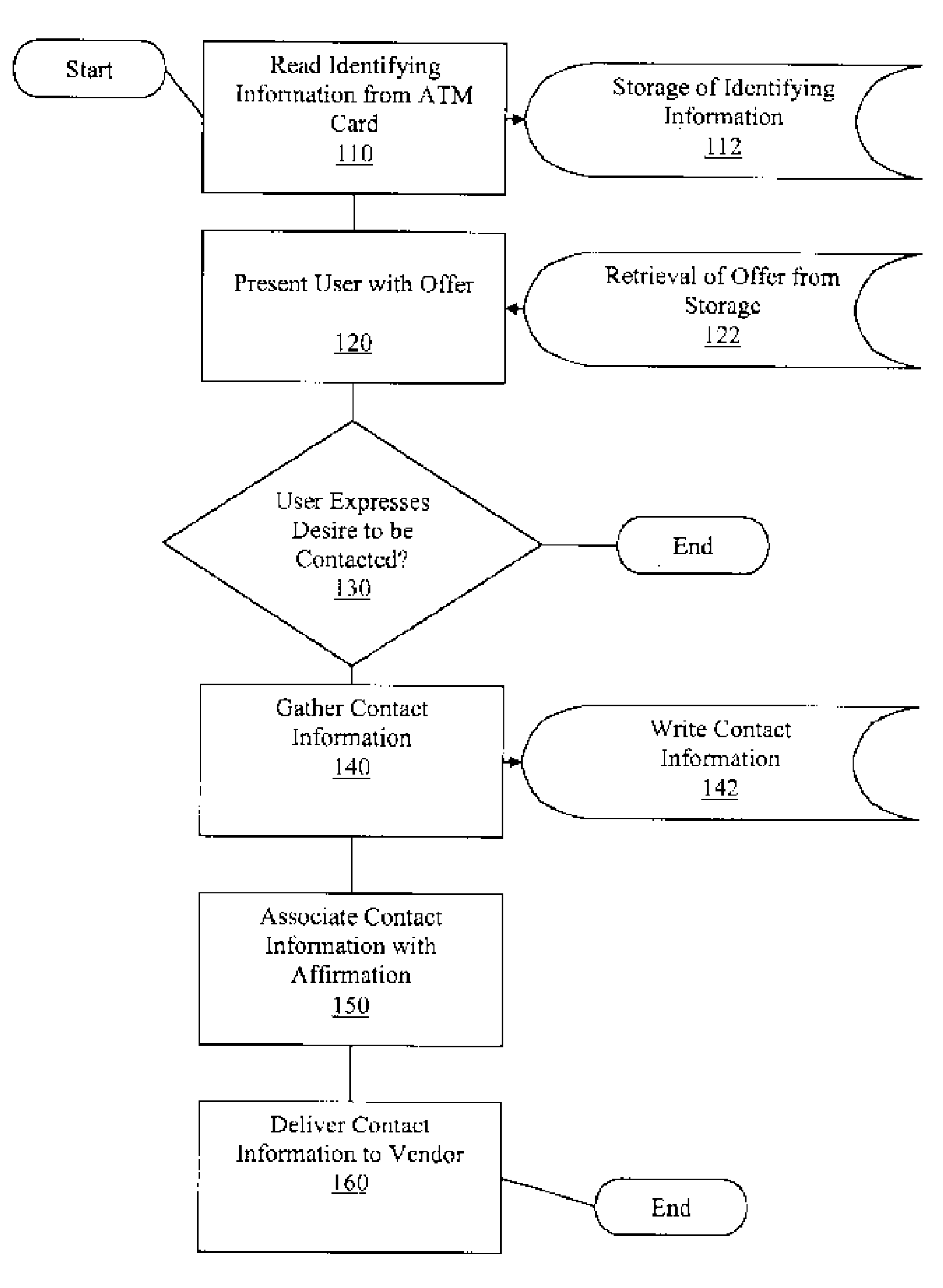

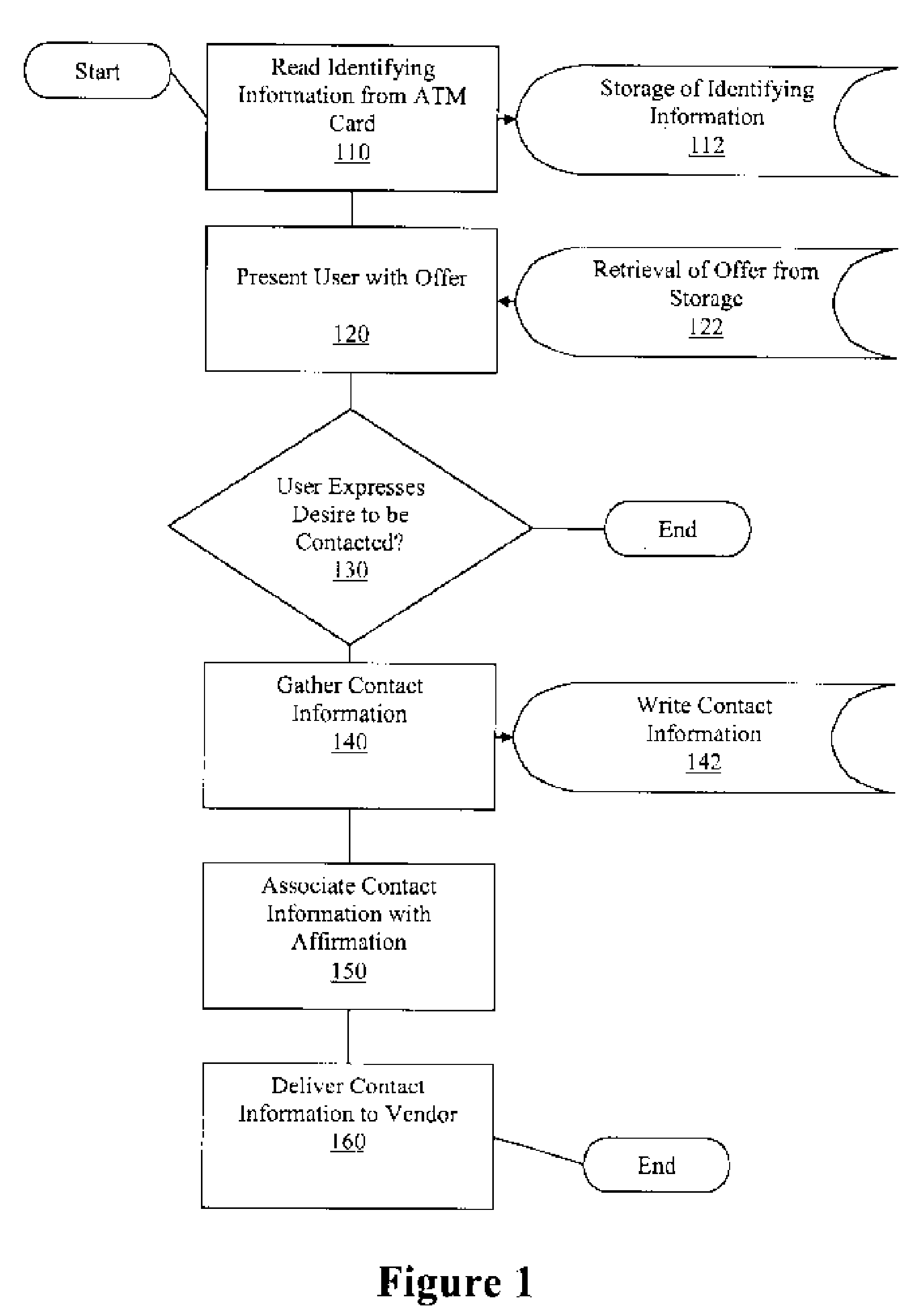

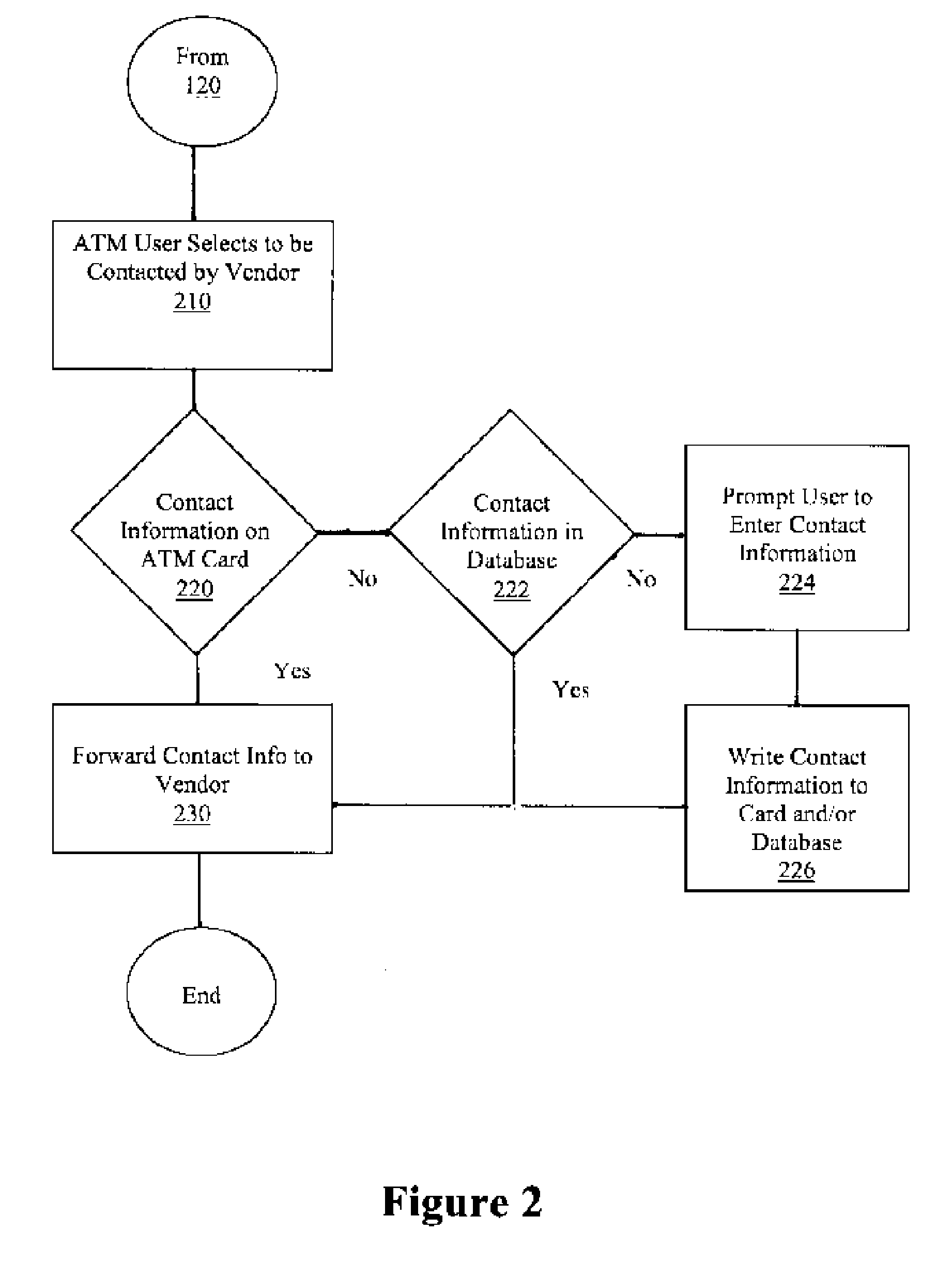

Automatic Teller Machine as Lead Source

There is a method of generating a business lead from a user of an automatic teller machine (ATM), including: reading identifying information from an ATM card of the user; presenting the user with a business offer; enabling the user to affirm a desire to be contacted by actuating only a single actuator; gathering user contact information; writing the contact information to the card; associating the contact information with the affirmation of the offer; and providing a business lead to a vendor. There is also: associating the identifying information and the contact information; presenting a second offer; receiving an affirmation of the second offer; accessing the contact information from the storage device according to the association with the identifying information; and associating the contact information with the affirmation of the offer. A record of the offer / acceptance is stored on the card.

Owner:VARGA KRISTIE A

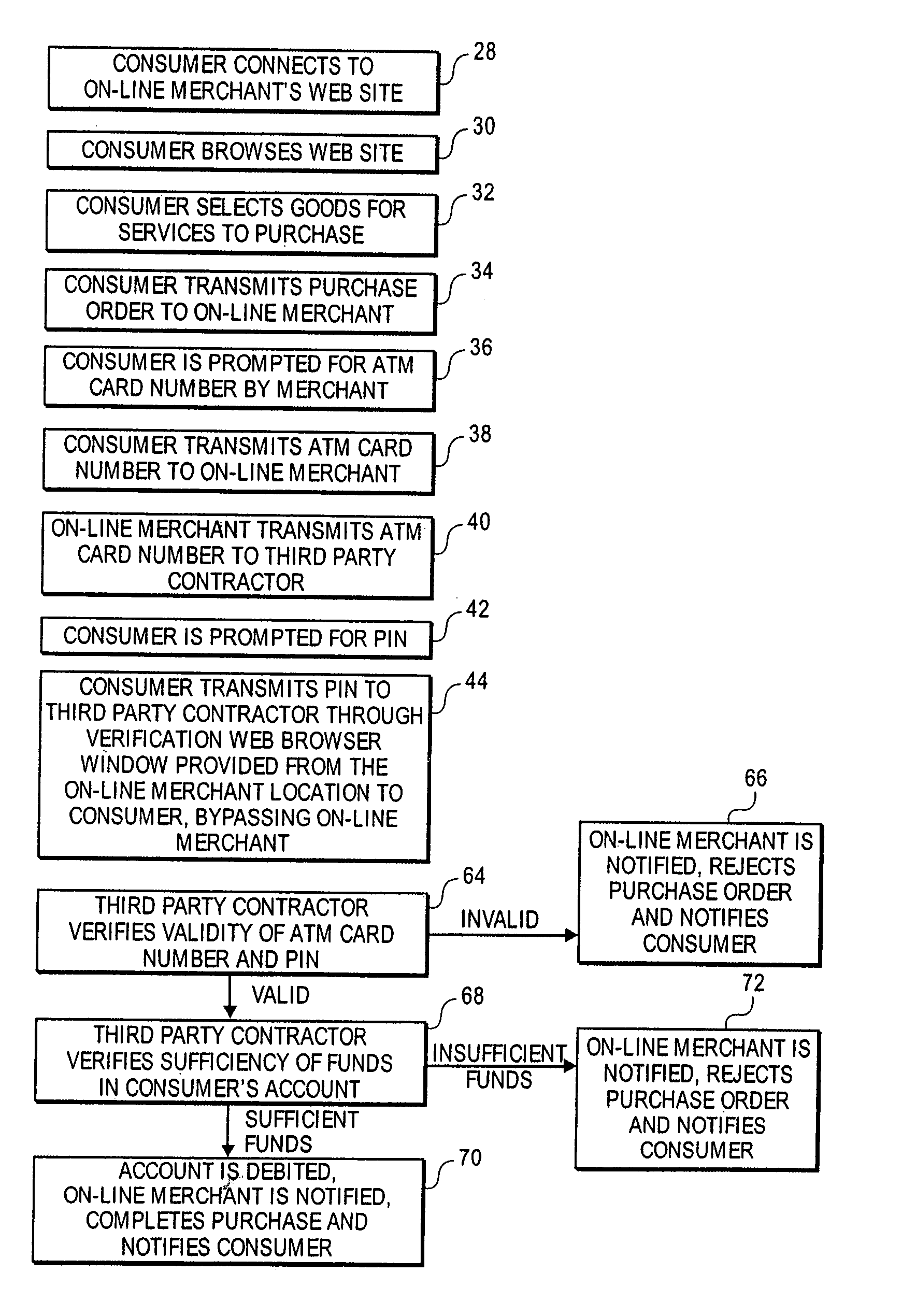

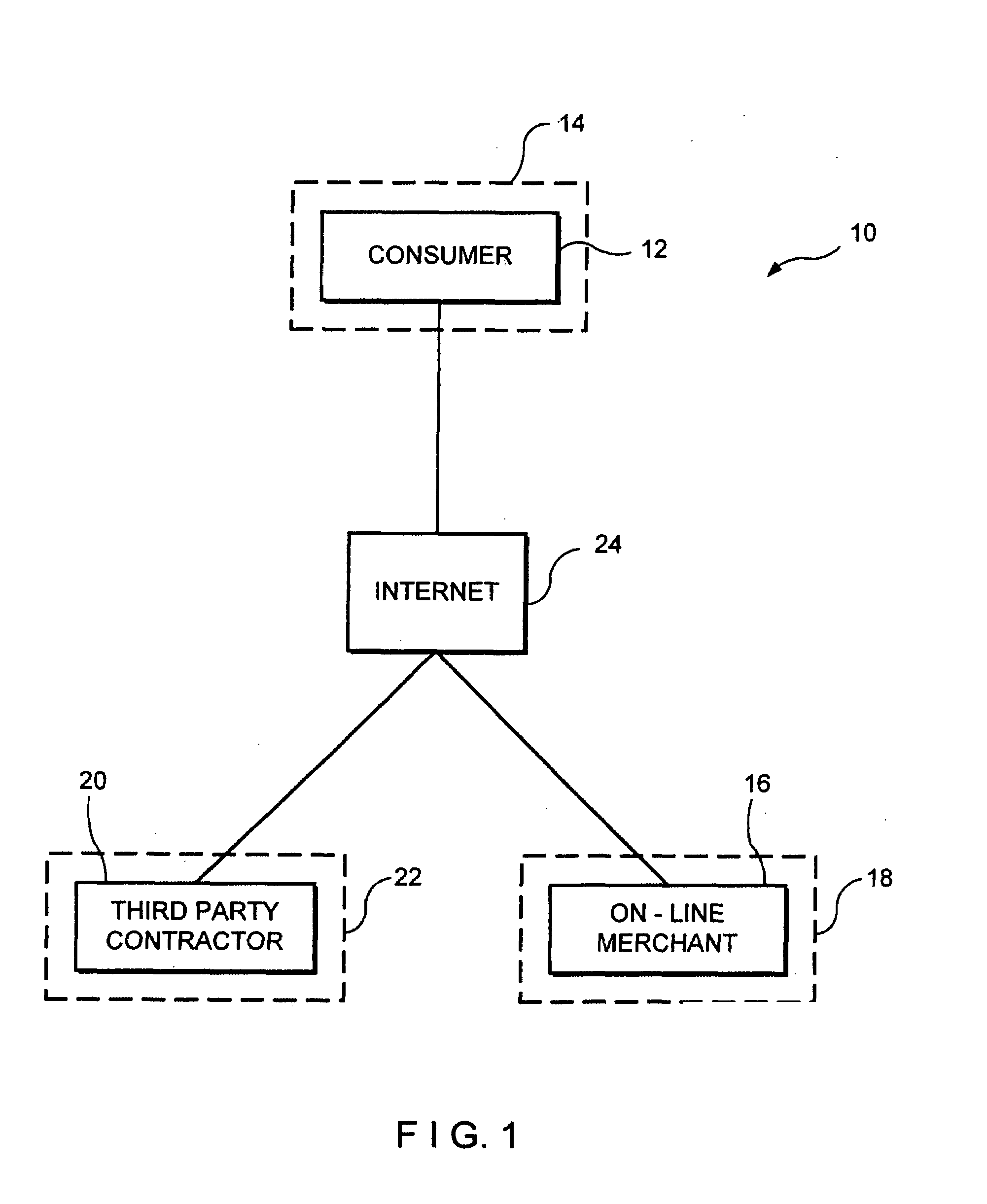

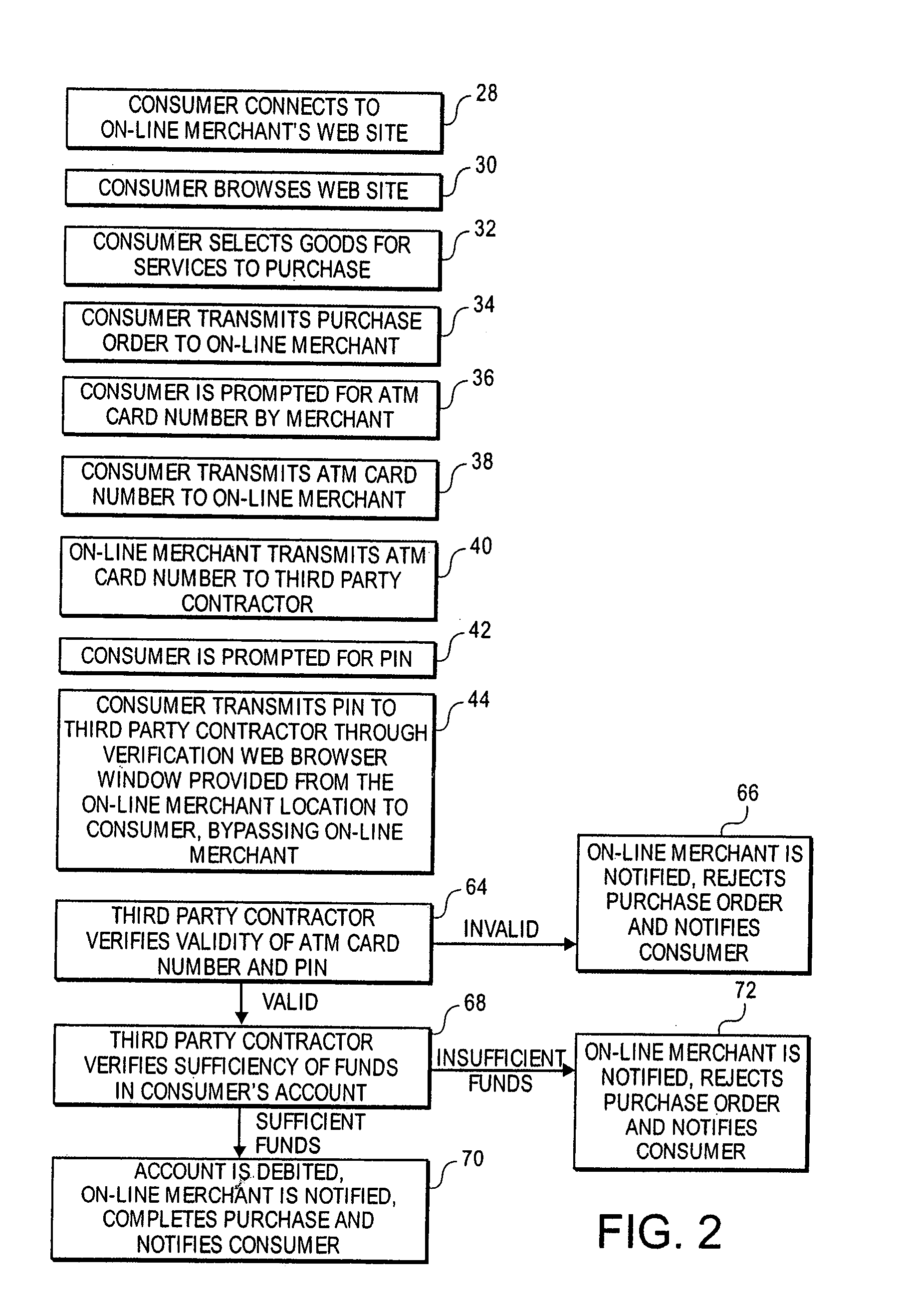

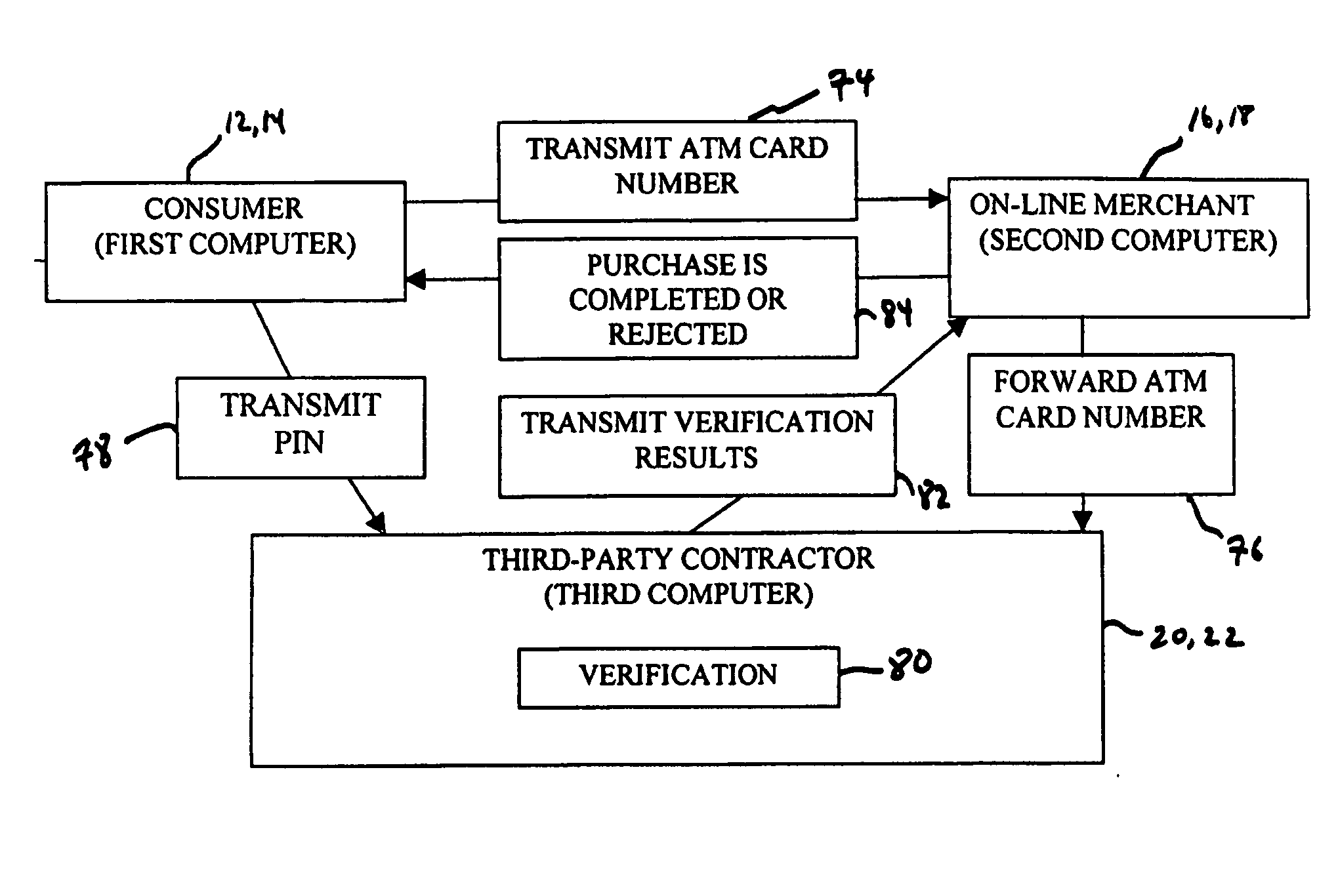

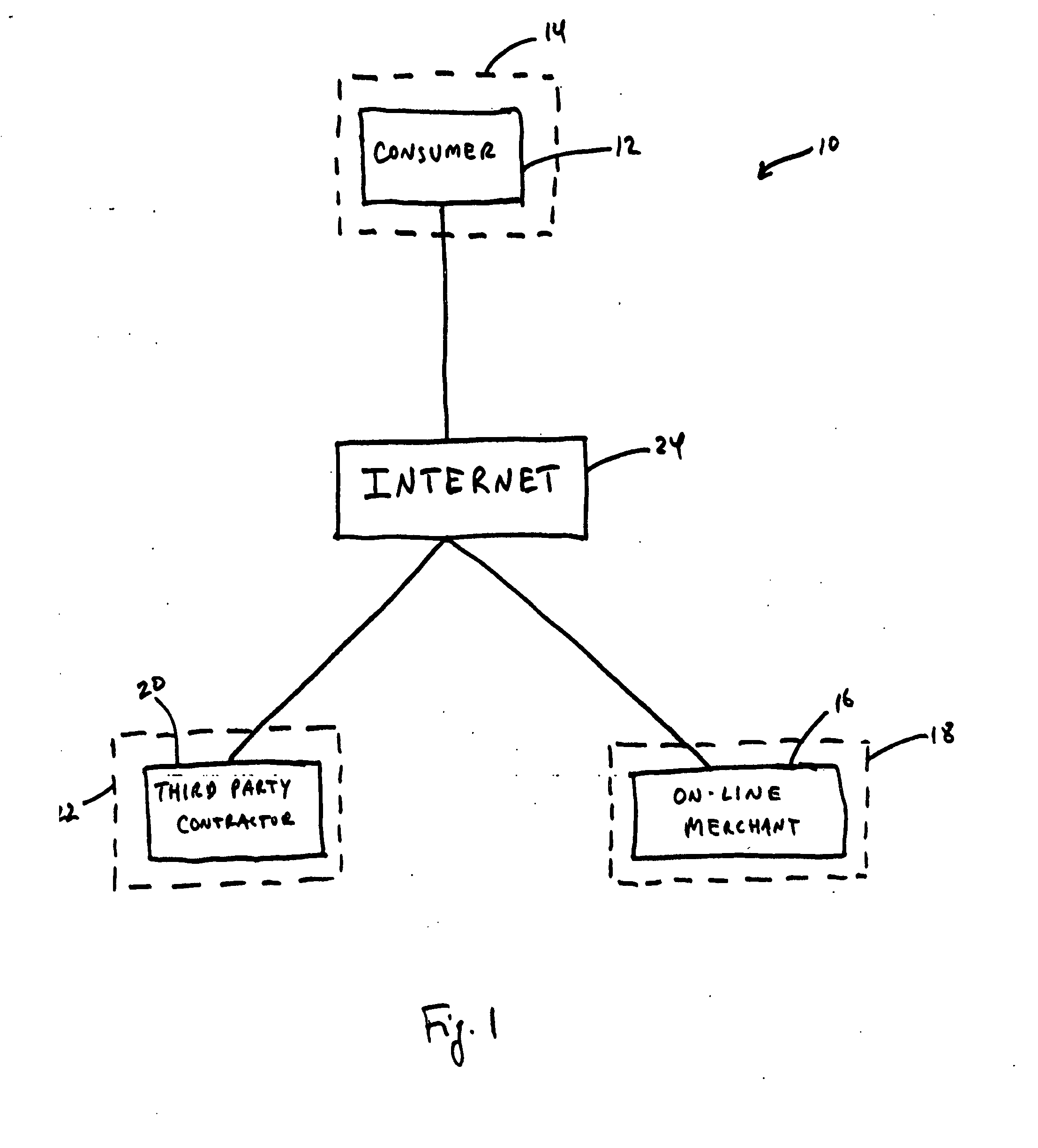

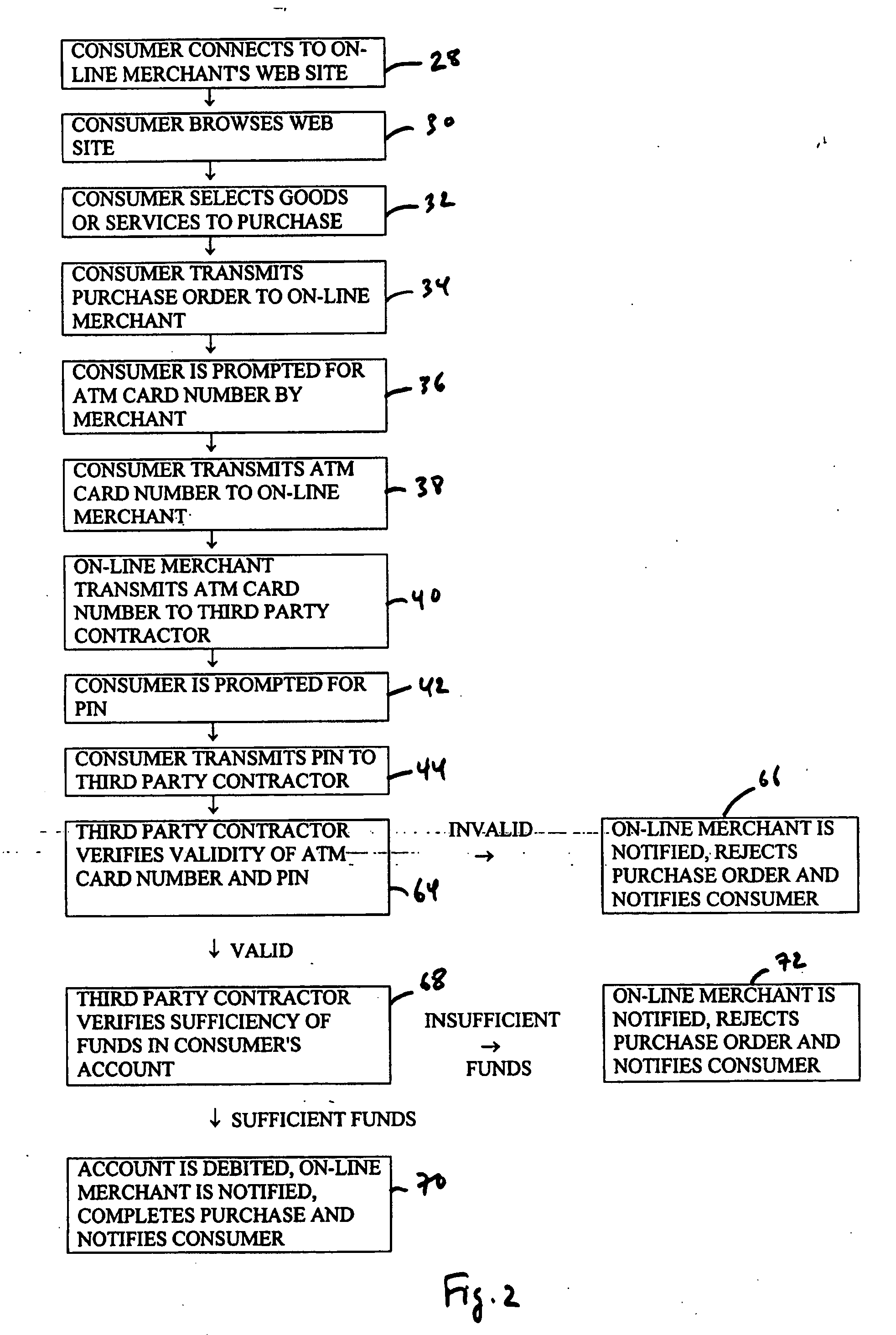

Method of and system for making purchases over a computer network

A method of and system for making purchases over a computer network using an ATM card or the like is provided. In accordance with the invention, a consumer transmits his ATM card number over the network to an on-line merchant. The on-line merchant then forwards the ATM card number to a third party contractor, such as a bank, that will oversee and authorize the transaction. Simultaneously or thereafter, the consumer transmits his PIN over the network to the third party contractor, who verifies that the ATM card number and PIN are valid.

Owner:MASTERCARD INT INC

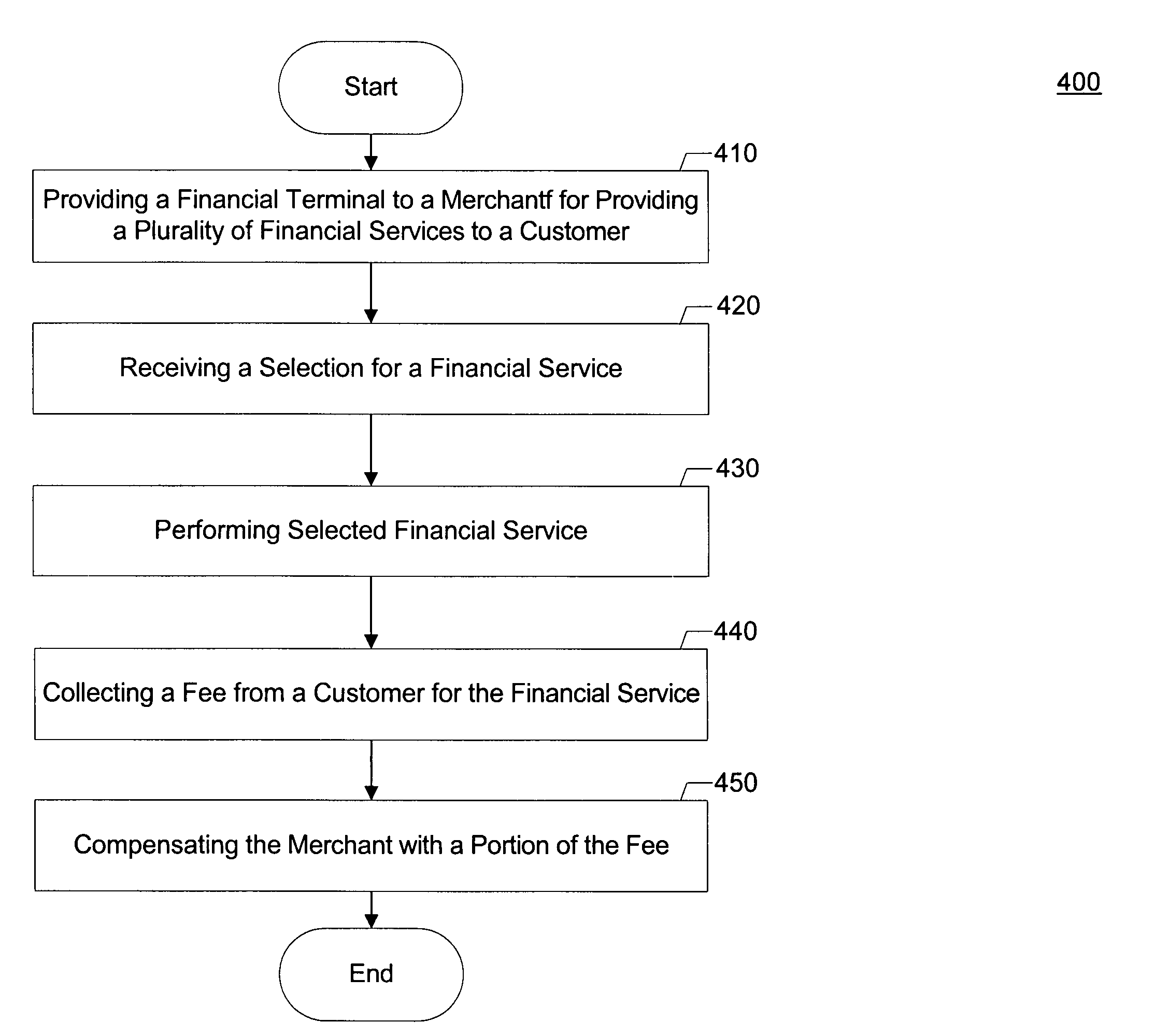

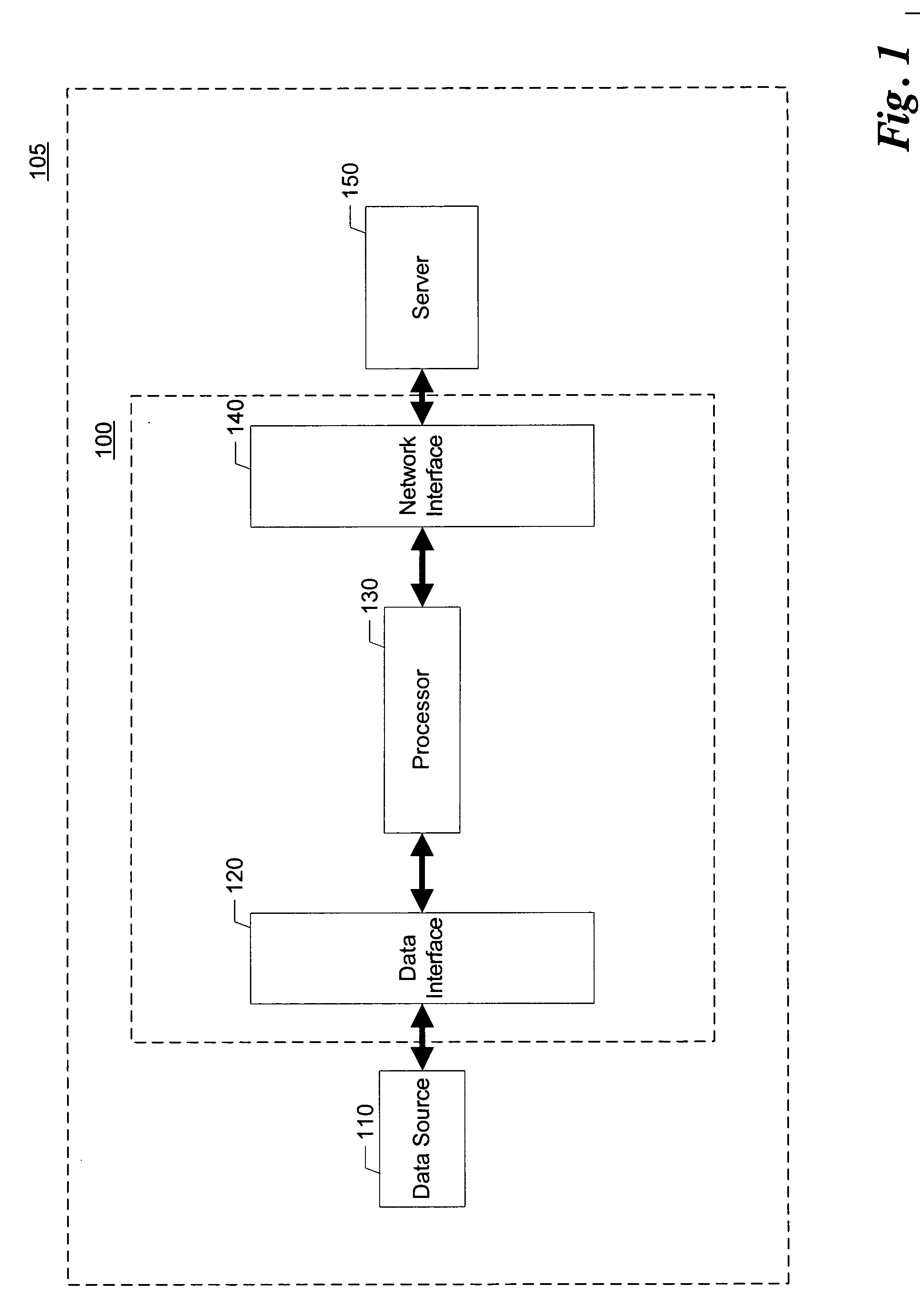

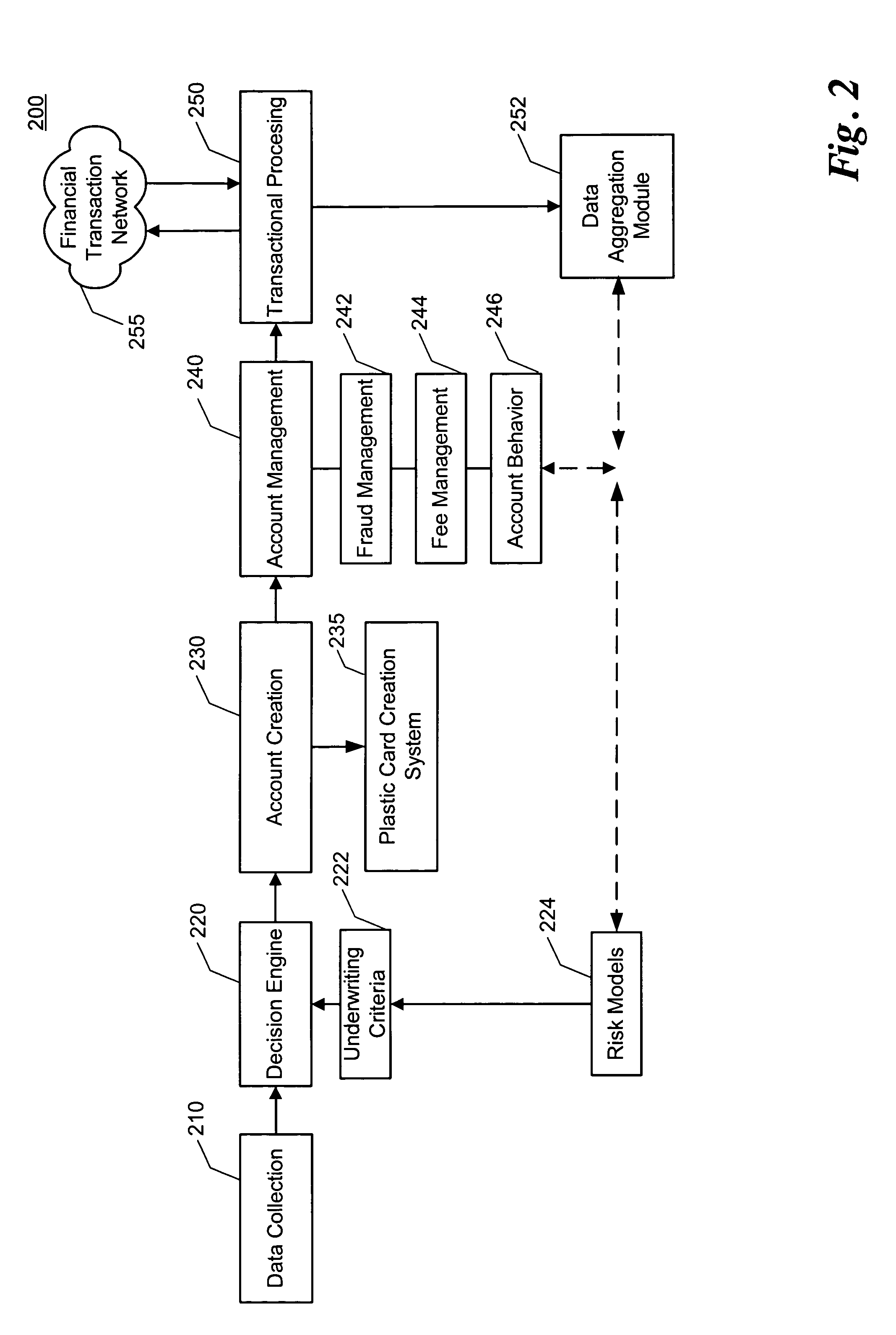

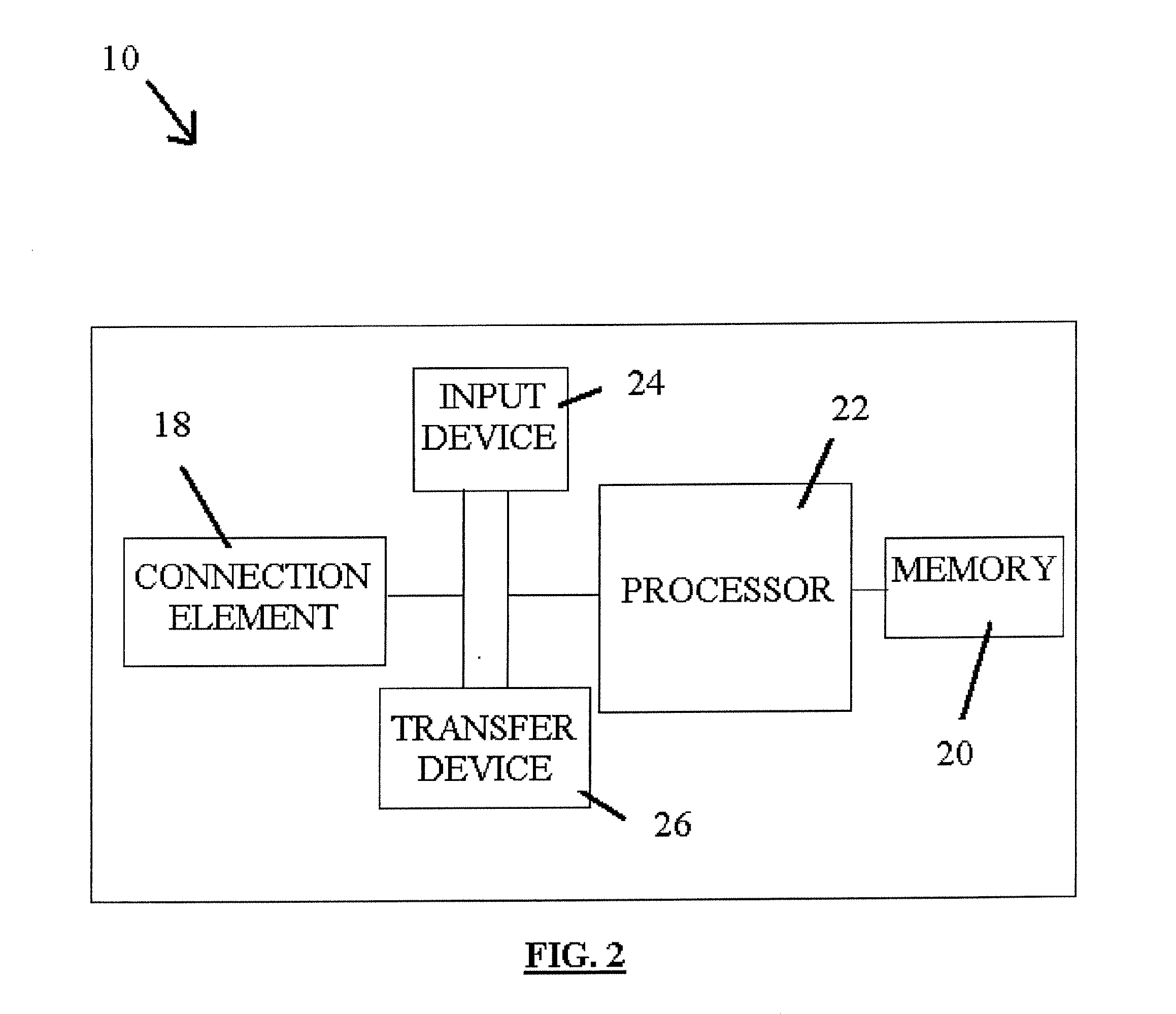

System, method and apparatus for providing financial services

The present invention is a system, method and apparatus for a terminal capable of accepting debit / credit or ATM cards, checks, money orders, cashiers checks, travelers checks, as well as a drivers license, state identification card, birth certificate and additionally any type of information that may be inputted into the terminal such as, but not limited to, an individuals direct deposit account (DDA) number, savings account number, etc. to facilitate a purchase, transfer of funds, wire of funds, cash-back option, etc. at a merchant location. In addition, the present invention will allow an individual to purchase pre-paid credit-type cards, pre-paid telecom cards, stamps, etc. at the terminal.

Owner:COMPUCREDIT INTPROP HLDG CORP II

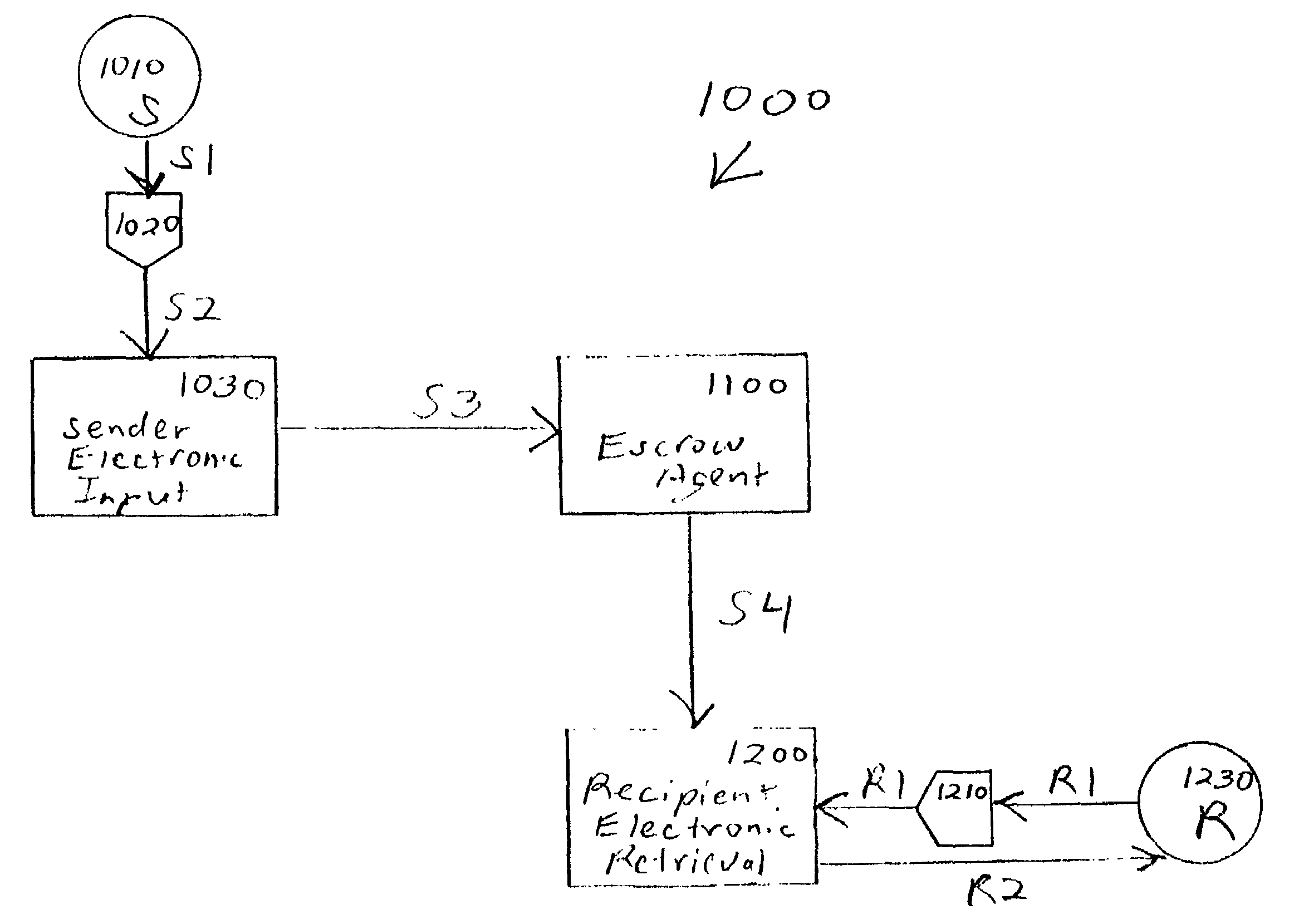

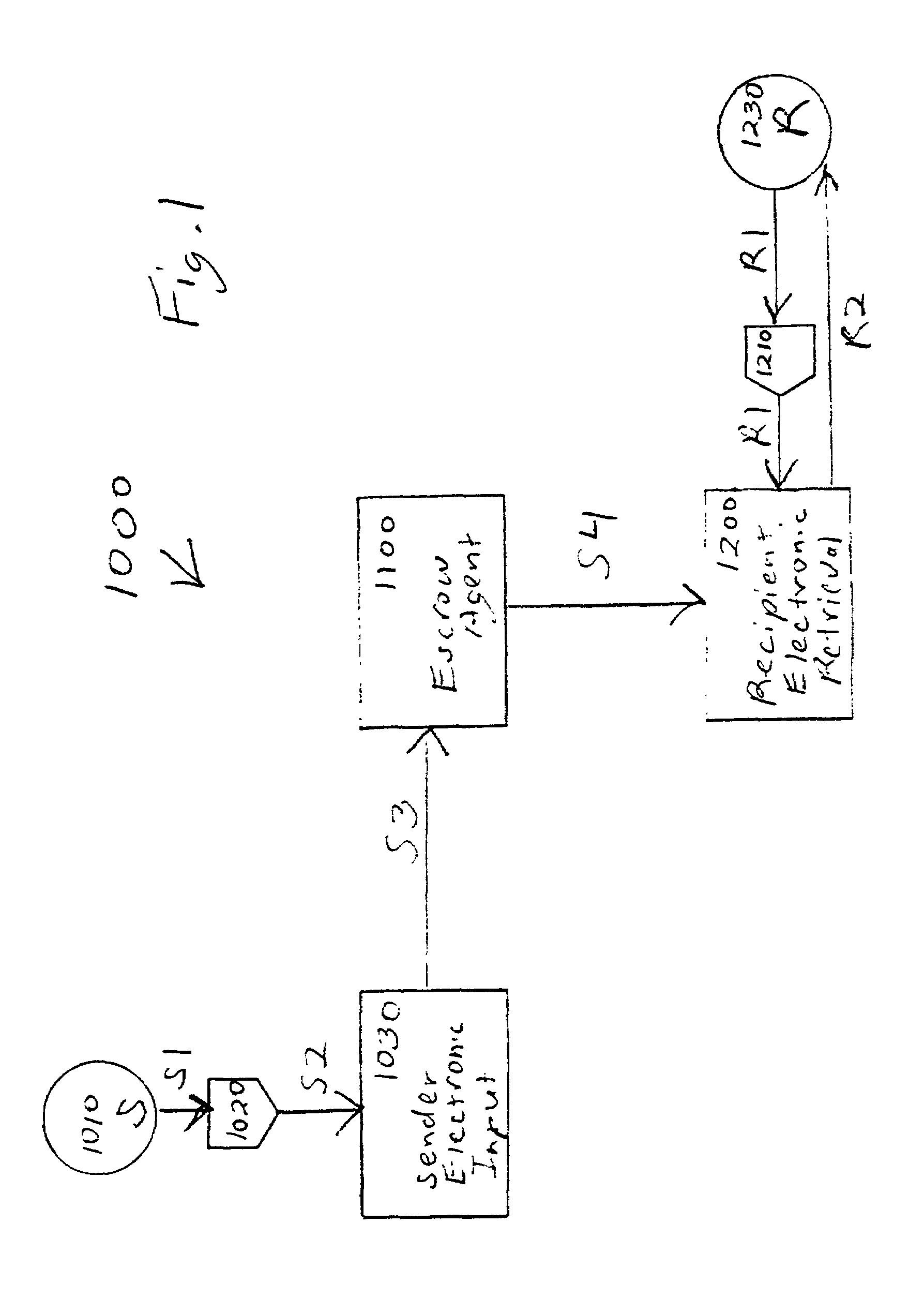

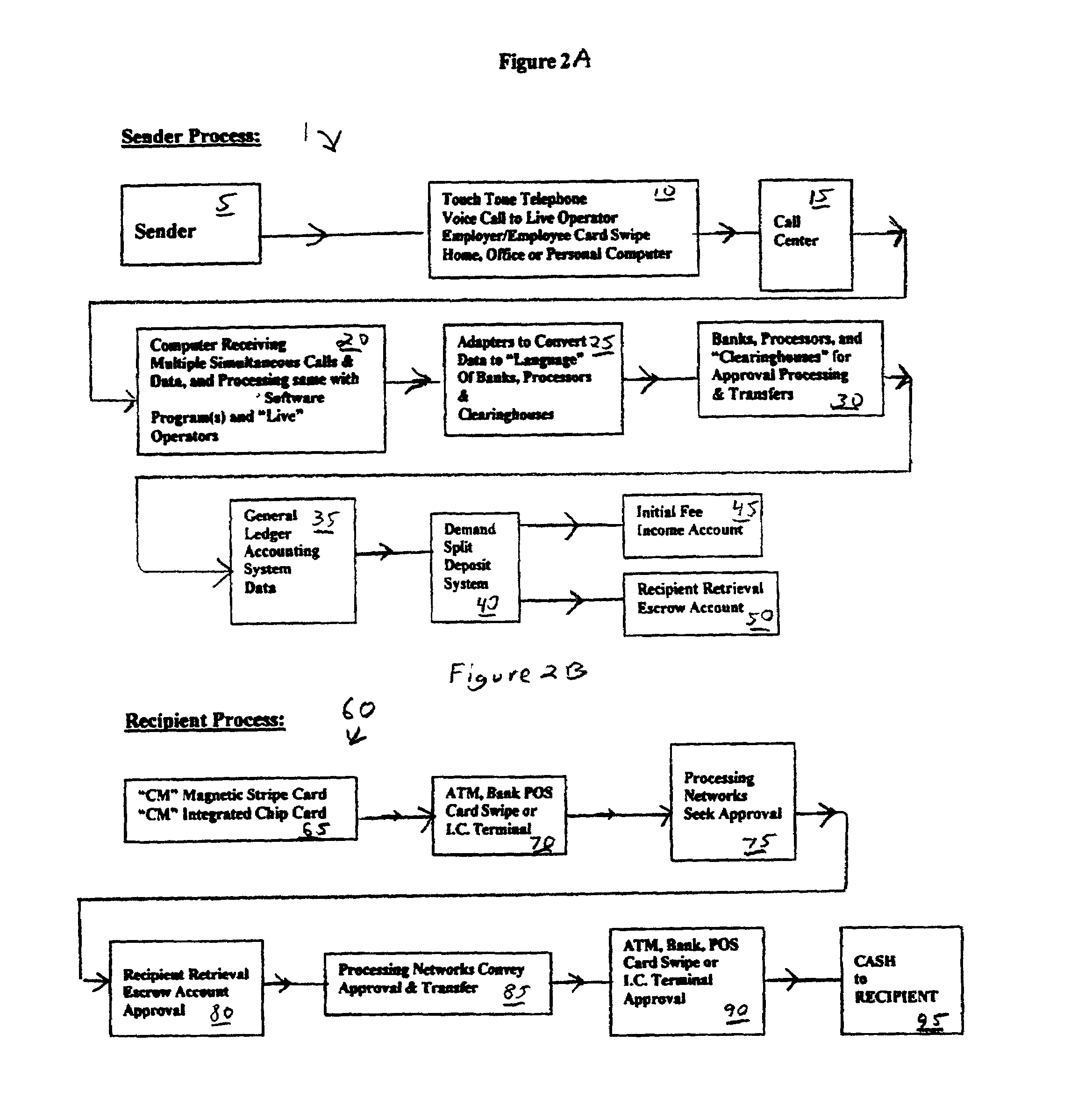

Integrated technology money transfer system

InactiveUS7415442B1Low costFinanceSpecial service for subscribersModem devicePersonal identification number

Money transfer system authorizing an escrow agent computer electronically by touch-tone telephone, computer modem, P.O.S.(point of sale) terminal, live operators, to send cash transfers from a sender's account such as their credit, debit, bank, or ATM card, or a bank account, to a recipient who accesses the money at any remote ATM type location or P.O.S.(point of sale) terminal by using cards such as a specialized magnetic cards, credit cards, debit cards, and automated teller machine(ATM) card, at anytime and anywhere. Senders can authorize the transfer by touch-tone and PIN(personal identification number) secure codes. The system can operate without pre-existing relationships, and monitor transactions and take surcharges based on transfer amounts, and use a cards tethered to ATM machines and be used with double magnetic sided cards.

Owner:INTEGRATED TECHNOLOGICAL SYST

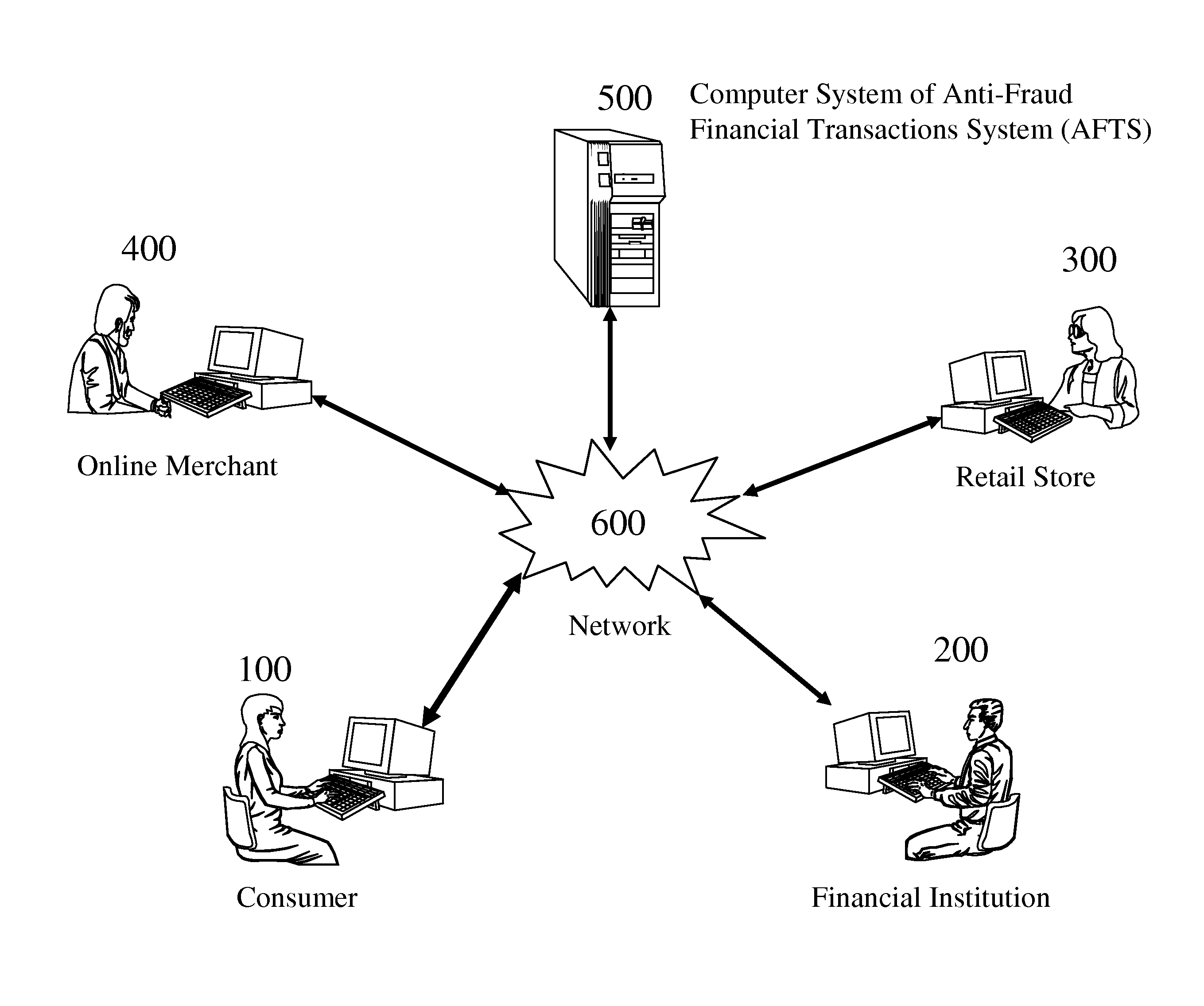

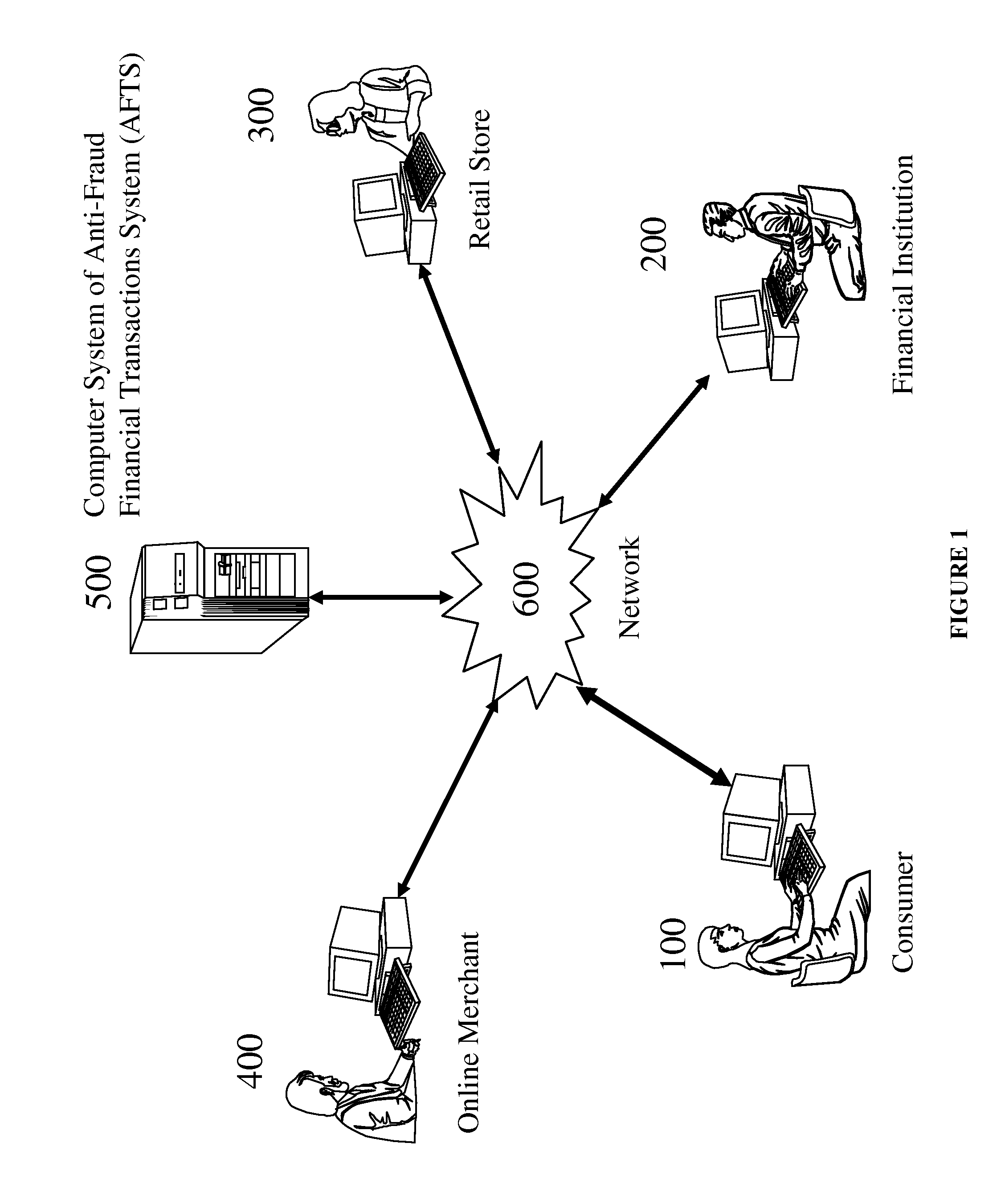

Anti-fraud financial transactions system

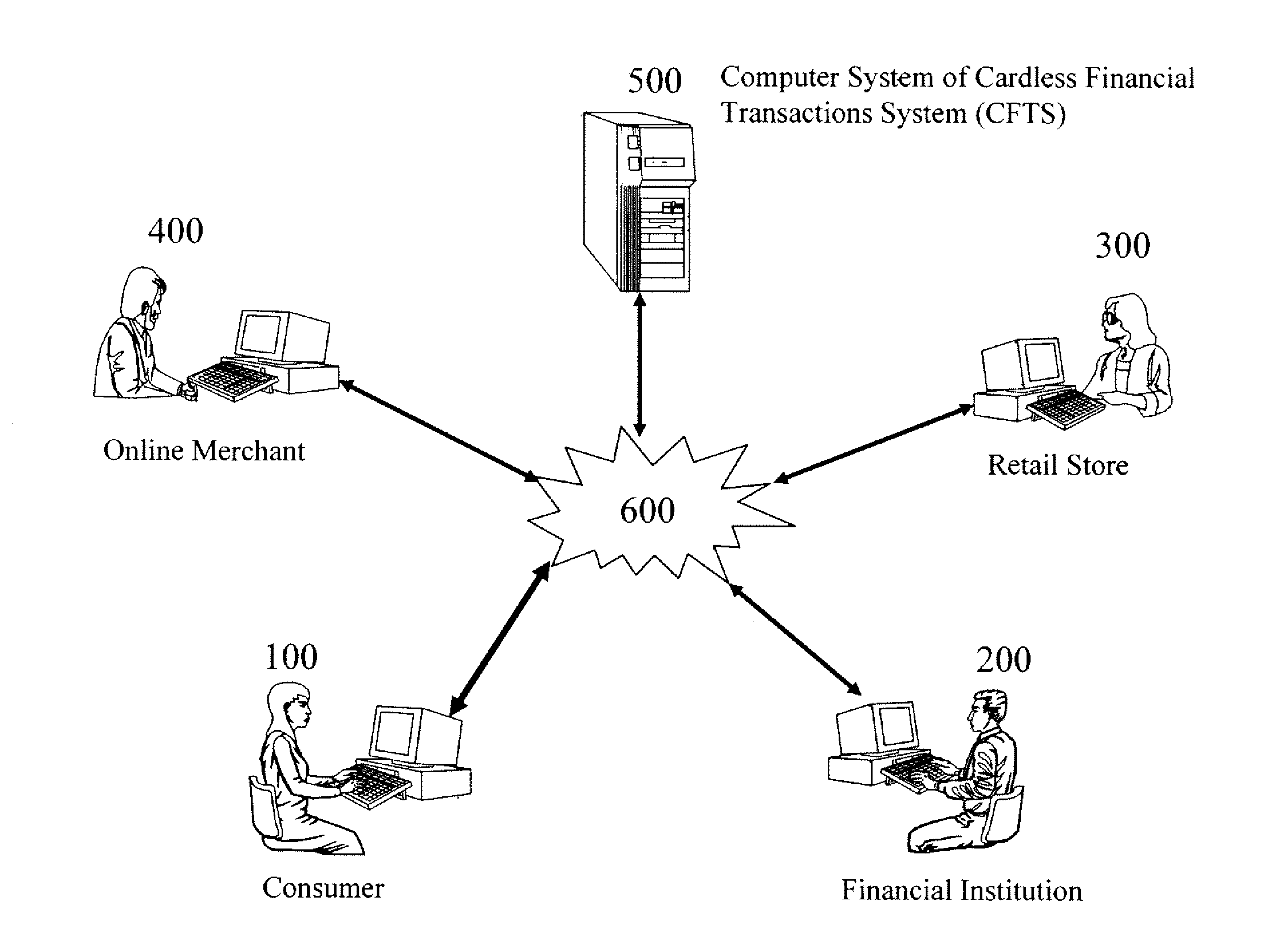

ActiveUS20130103482A1Easily fabricatedEasy to be stolenMarketingInternet privacyFinancial transaction

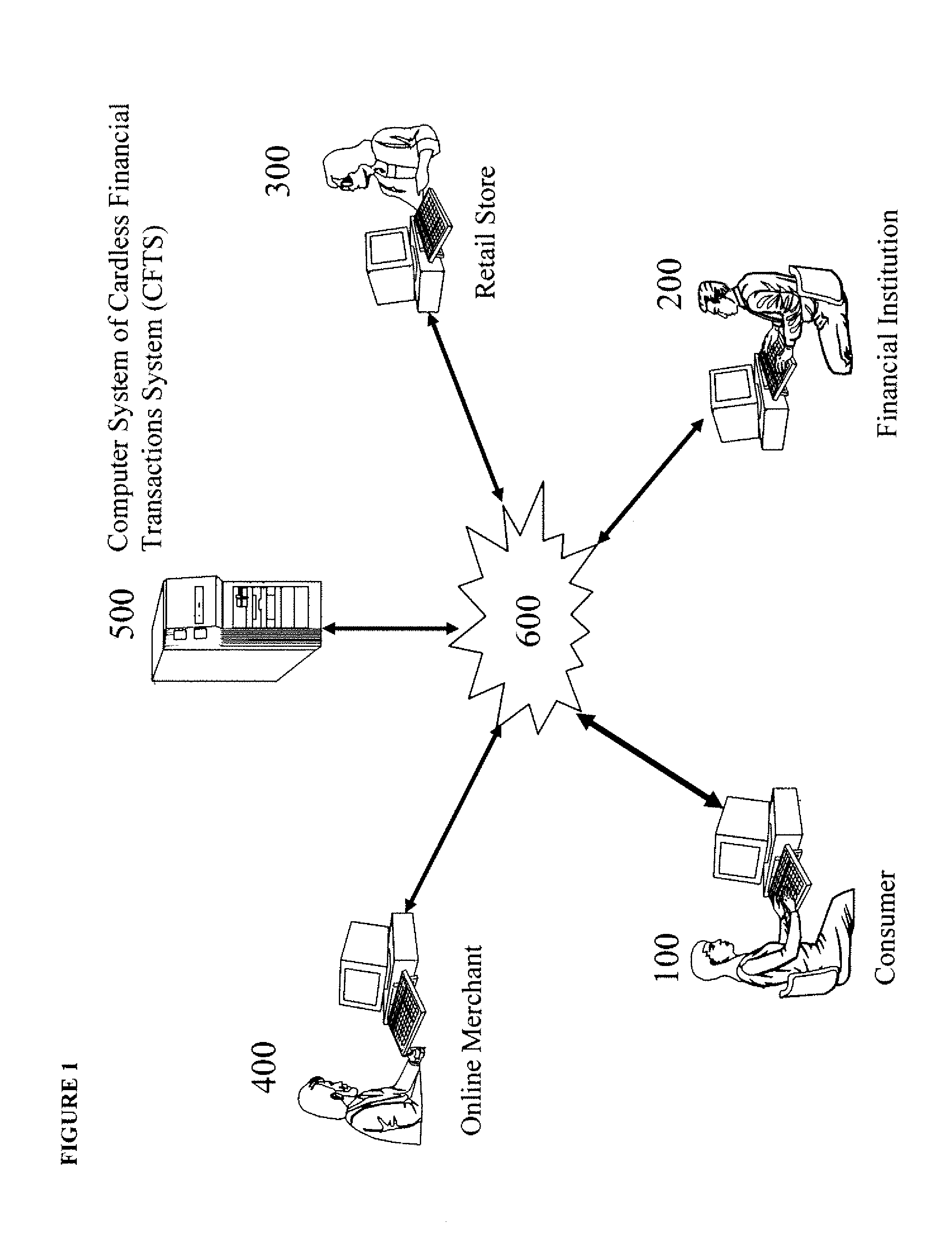

Users can conduct financial transactions in a secure manner without the need to use any traditional financial instrument, such as credit card, debit card, ATM card, gift card, stored value card, prepaid card, cash, check, coupon, token, ticket, voucher, certificate, note, security, etc. In addition, users' identities are kept confidential in the transactions without violating the Anti-Money Laundering and Anti-Terrorist Financing requirements.

Owner:SONG ALEXANDER +2

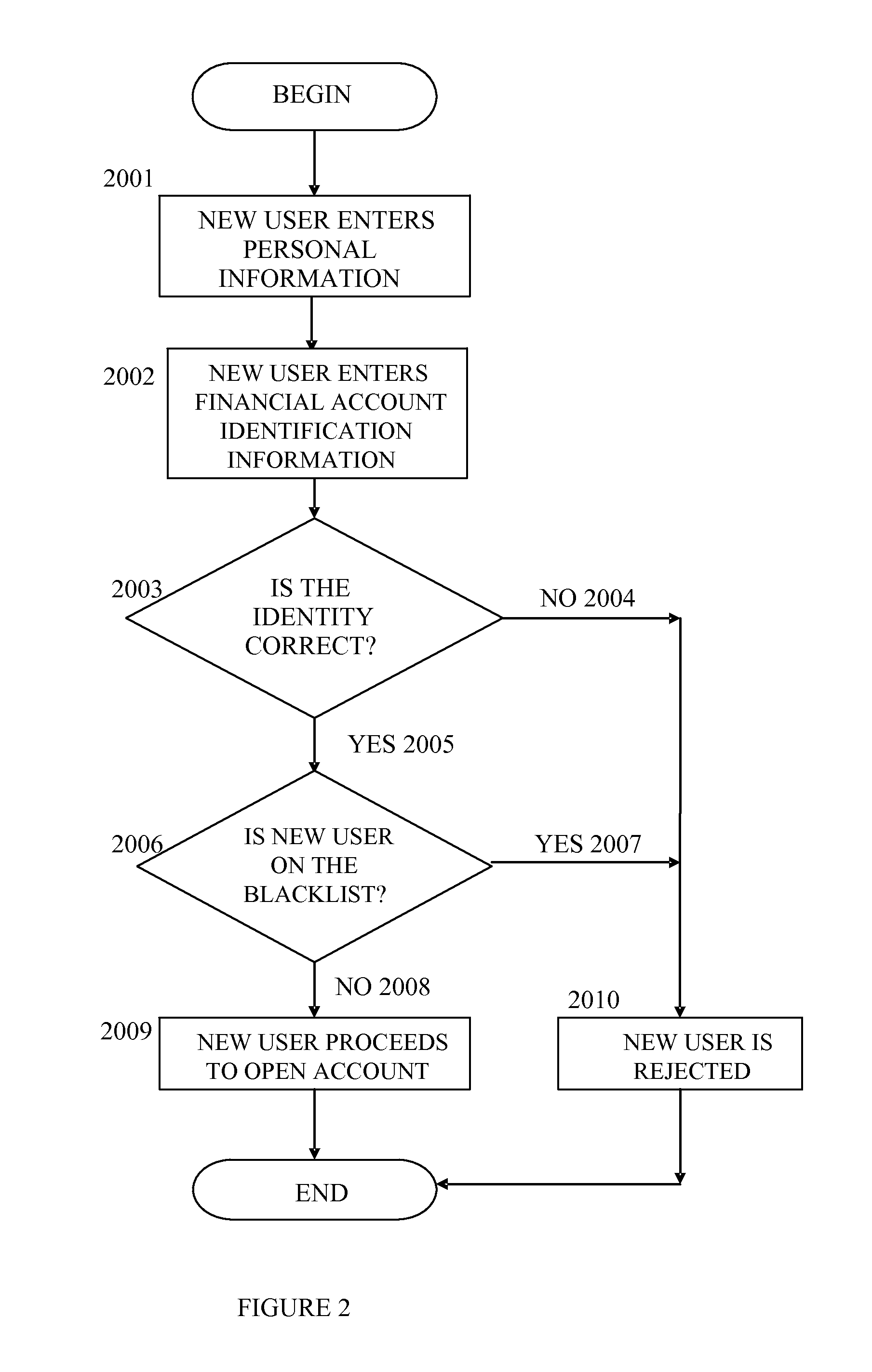

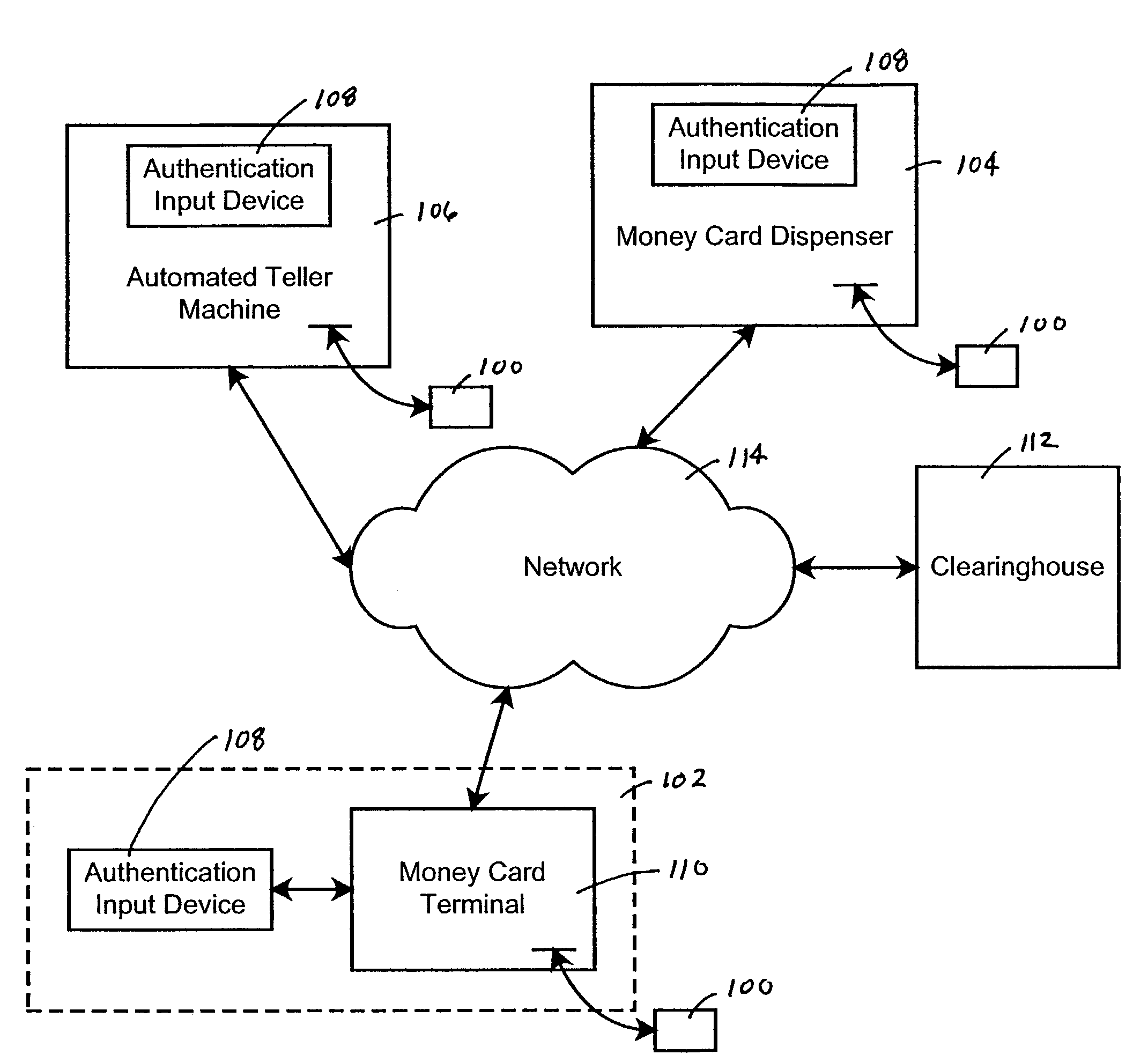

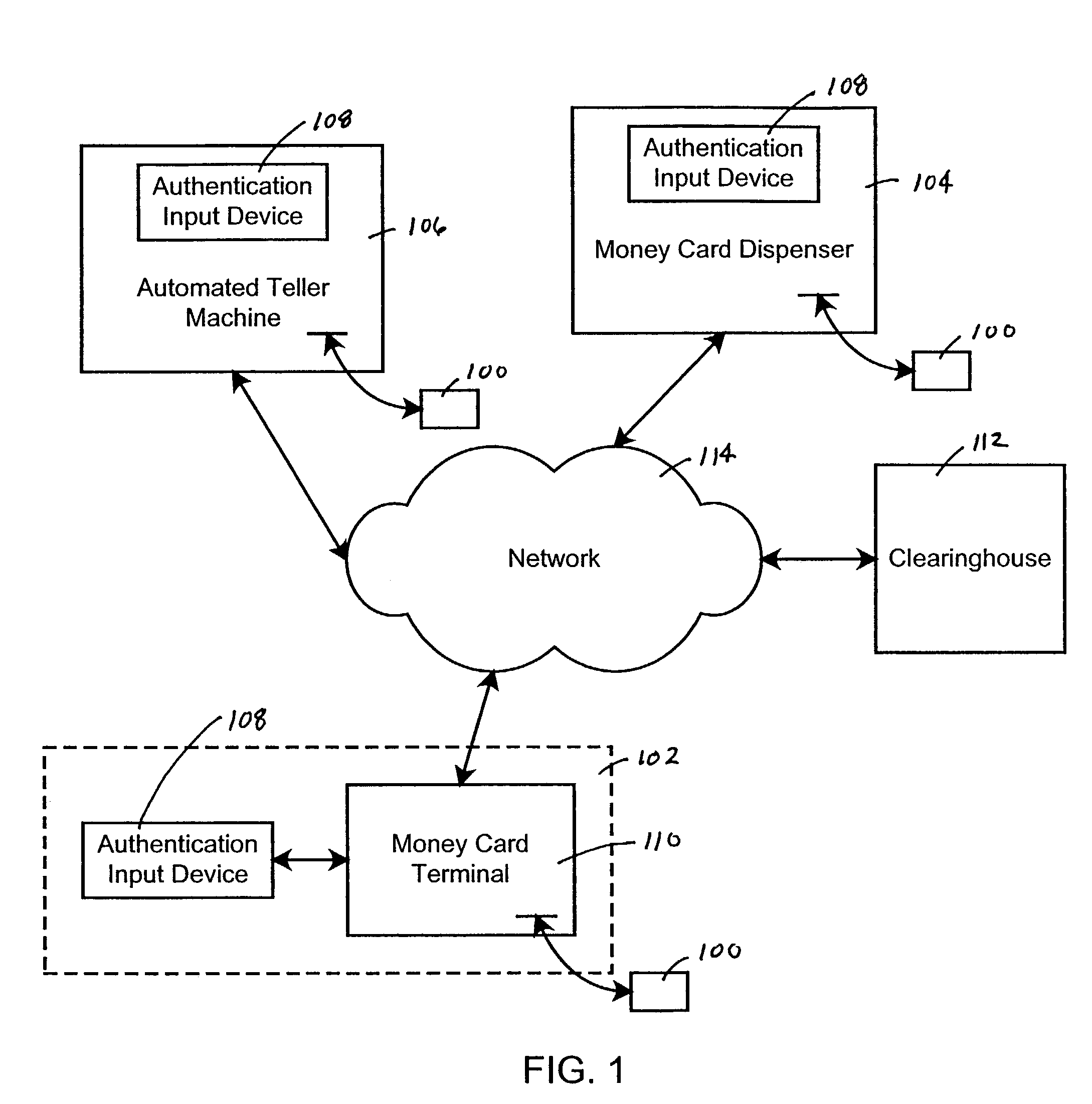

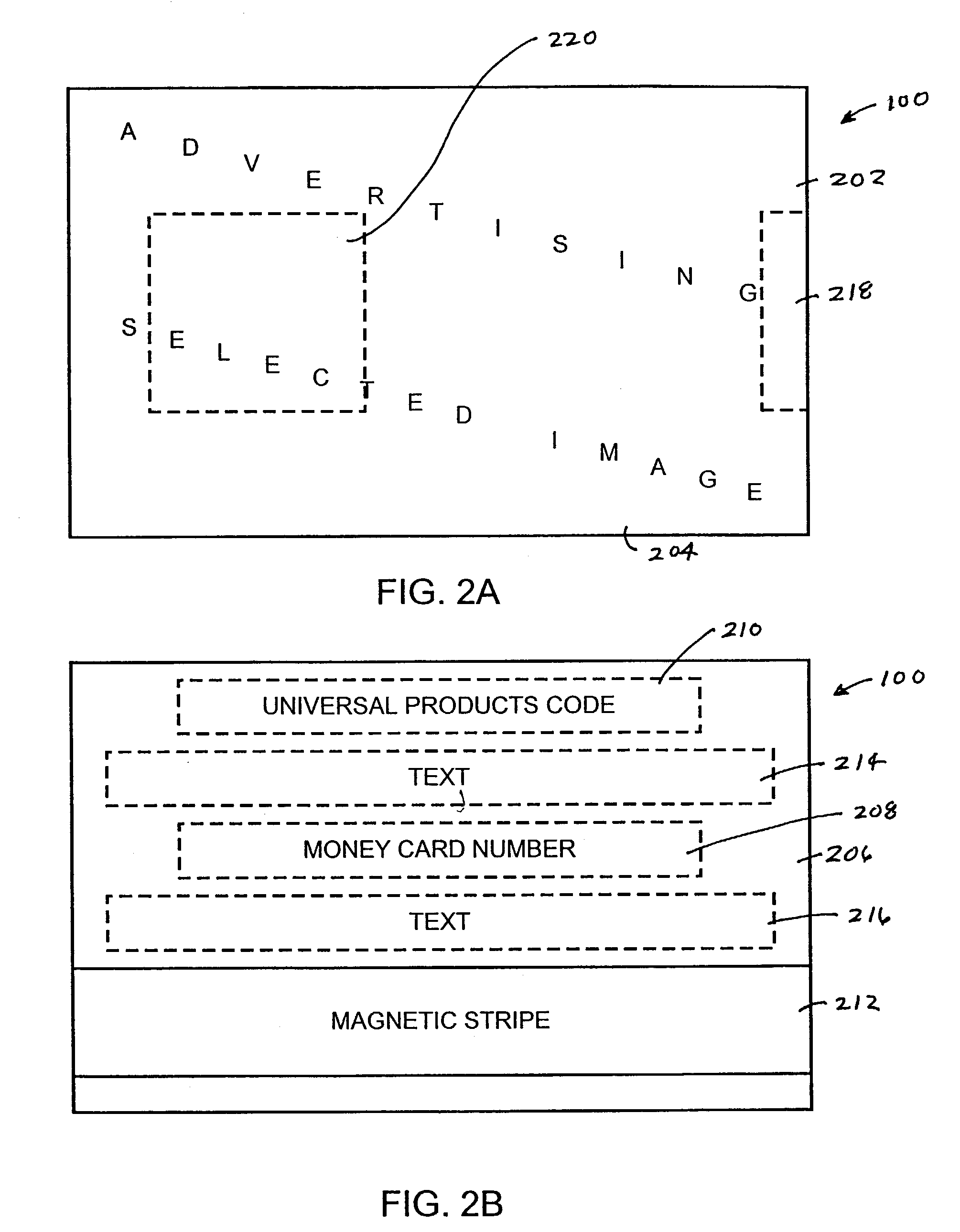

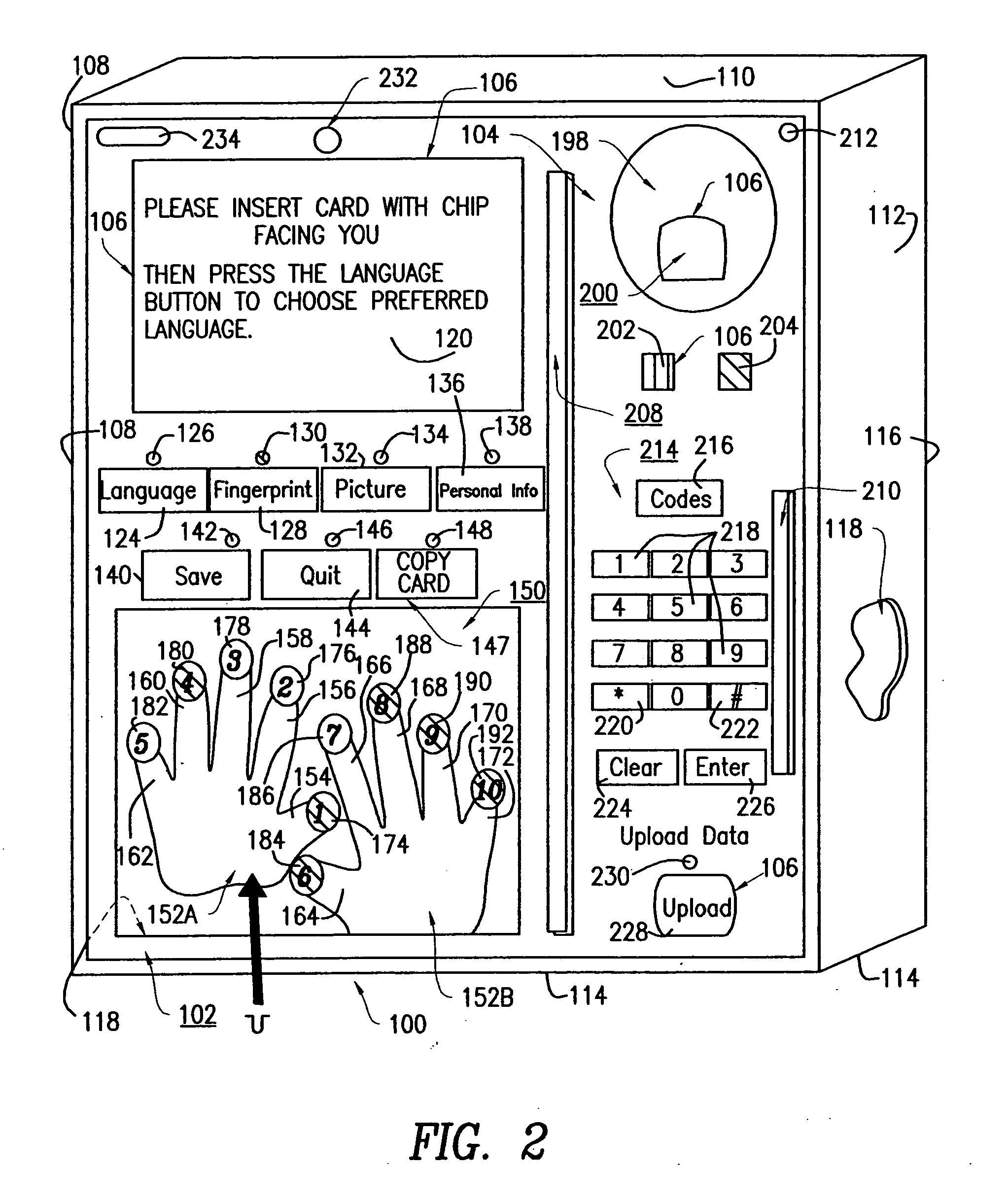

Money card system, method and apparatus

InactiveUS7280984B2Easy to useFunction increaseComputer security arrangementsDebit schemesPersonalizationSmart card

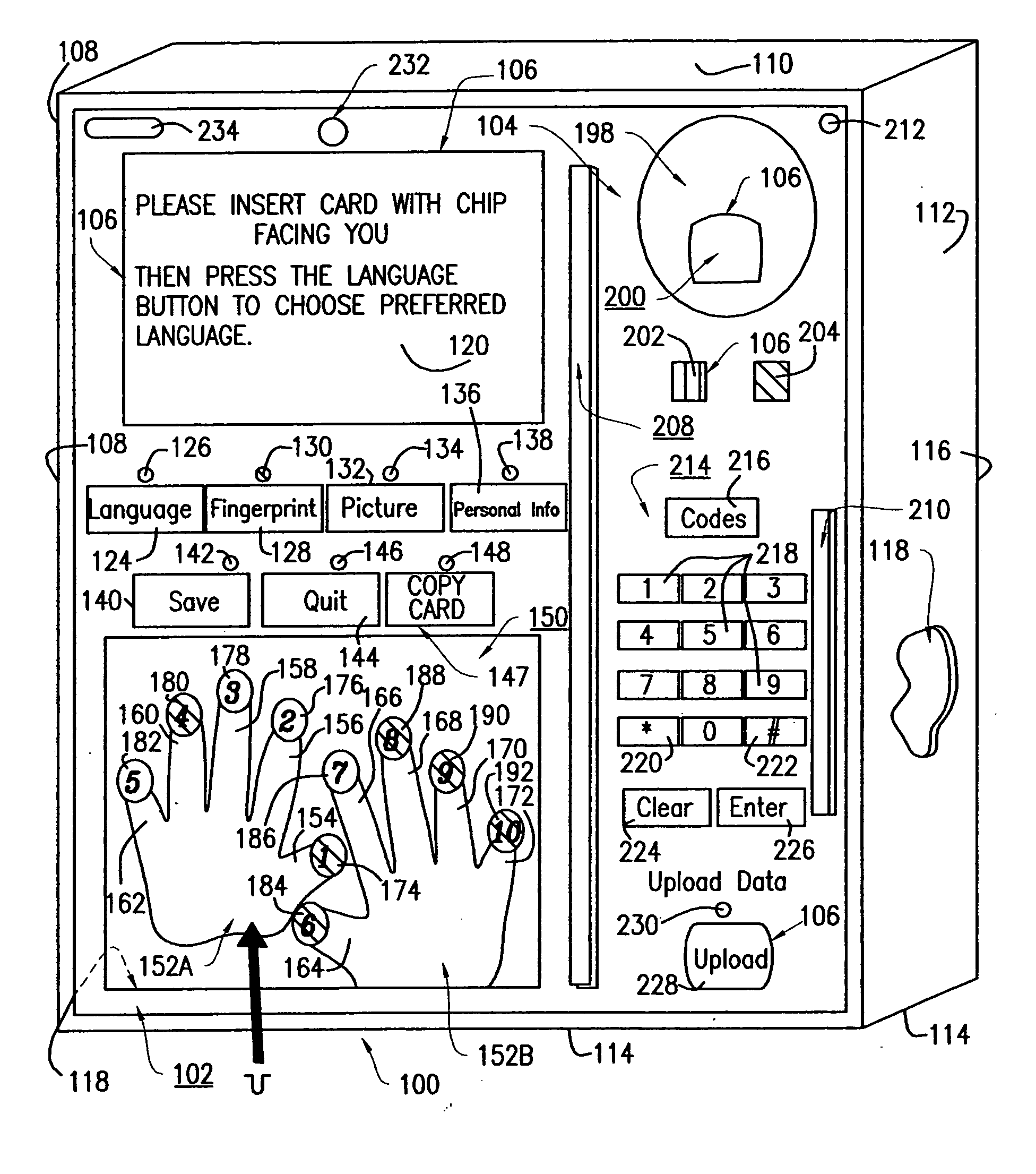

The present invention provides a money card system, method and apparatus that is convenient, easy to use, does not require good or any credit, is useable by individuals having low incomes, is interchangeable with cash, is available in many currencies, can be used in COD transactions, and is safer than cash, checks, money orders, cashier's checks, traveler's checks, ATM cards, credit cards, debit cards, stored-value cards and smart cards. For these individuals, the money card would provide the functionality of cash enhanced with the security of a Personal Identification Number (PIN) or Personal Identification Code (PIC) or other biometric information, such as fingerprint, handprint, voiceprint, iris scan, retina scan, thermal image, electronic / digital signature or any other form of endorsement that may be used to personalize and secure the transaction.

Owner:PHELAN PATRICIA MS

System and method for universal identity verification of biological humans

InactiveUS20090224889A1Rapid diagnosisQuick treatmentLocal control/monitoringTelemedicineCredit cardMedical treatment

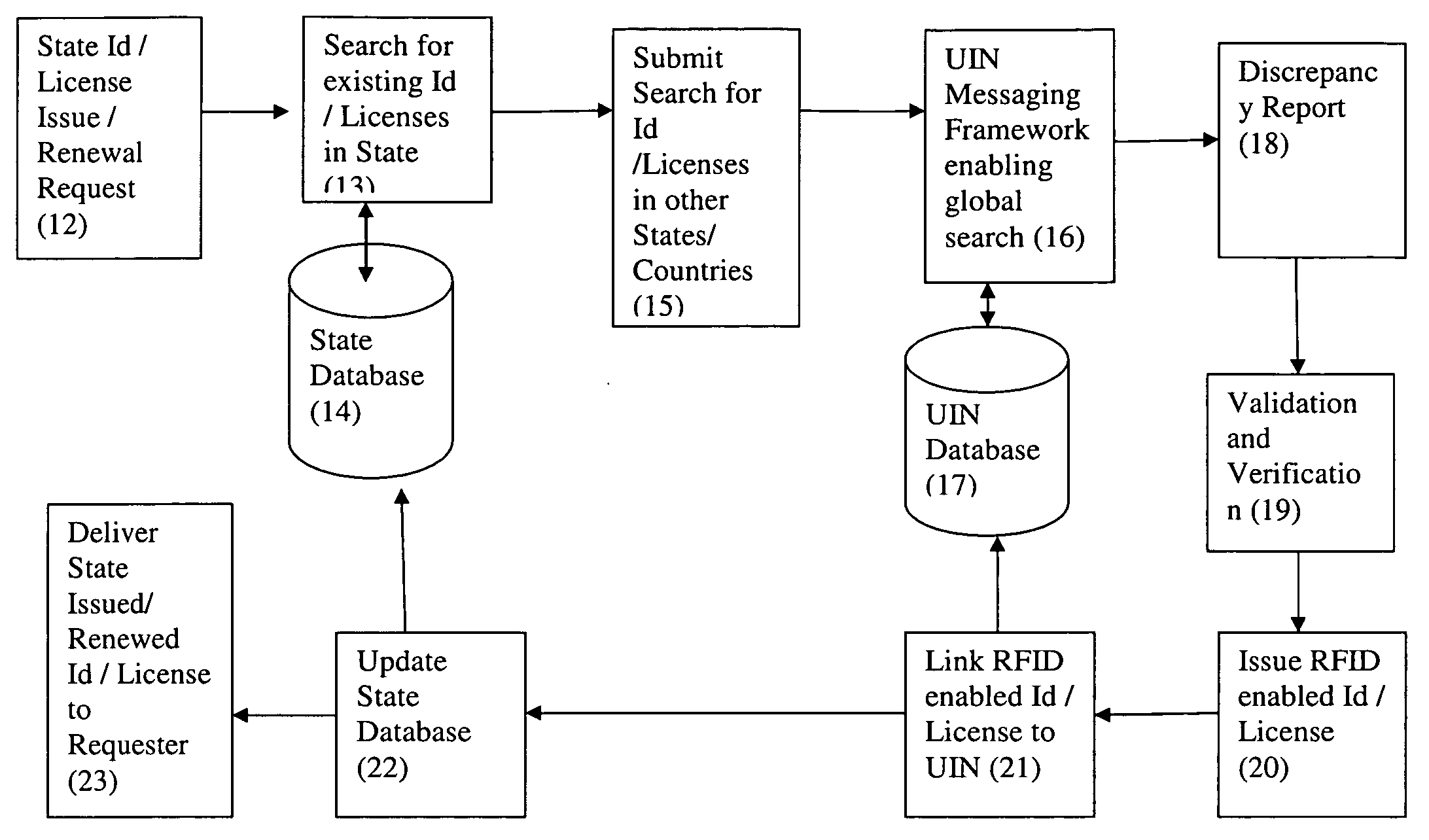

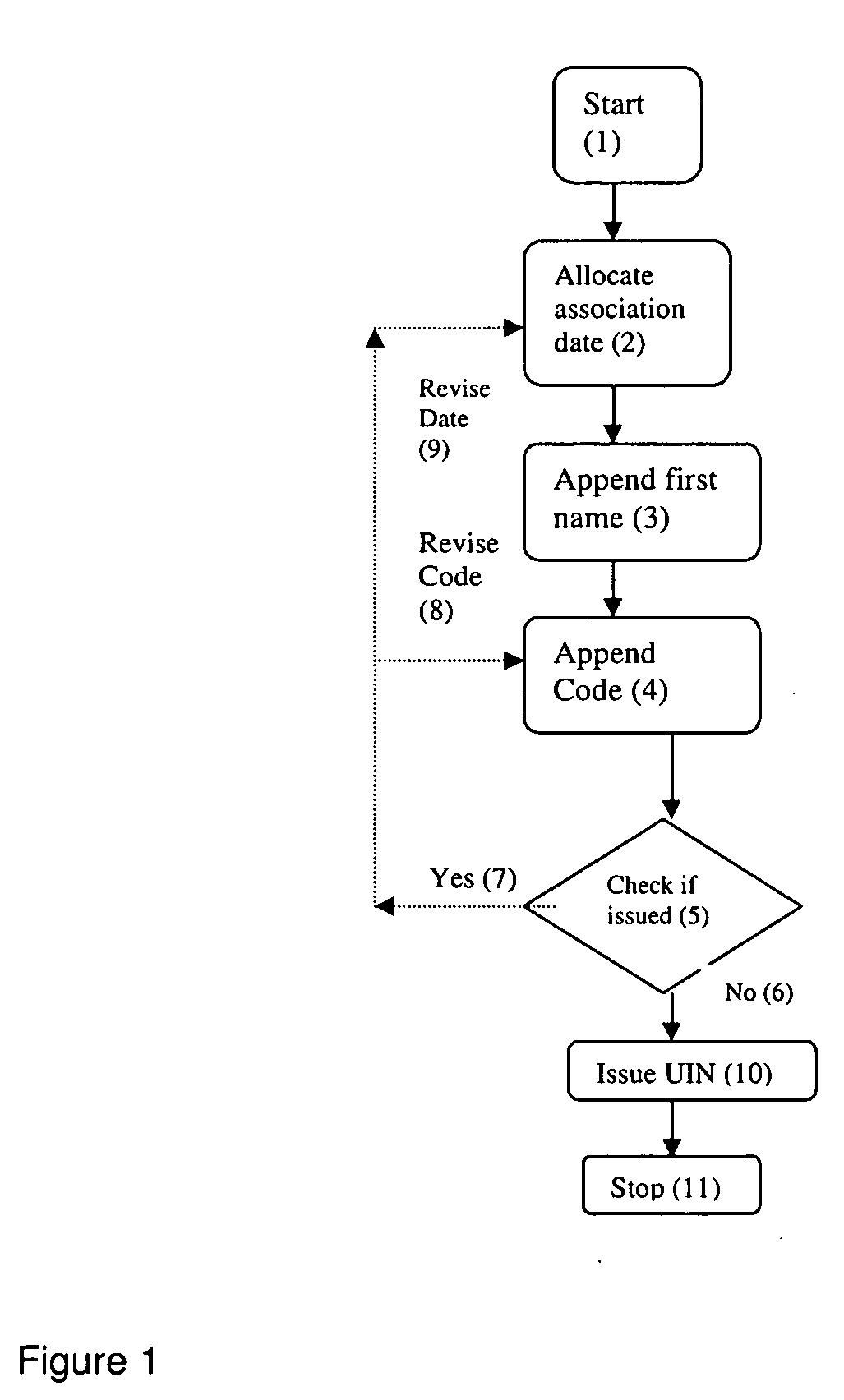

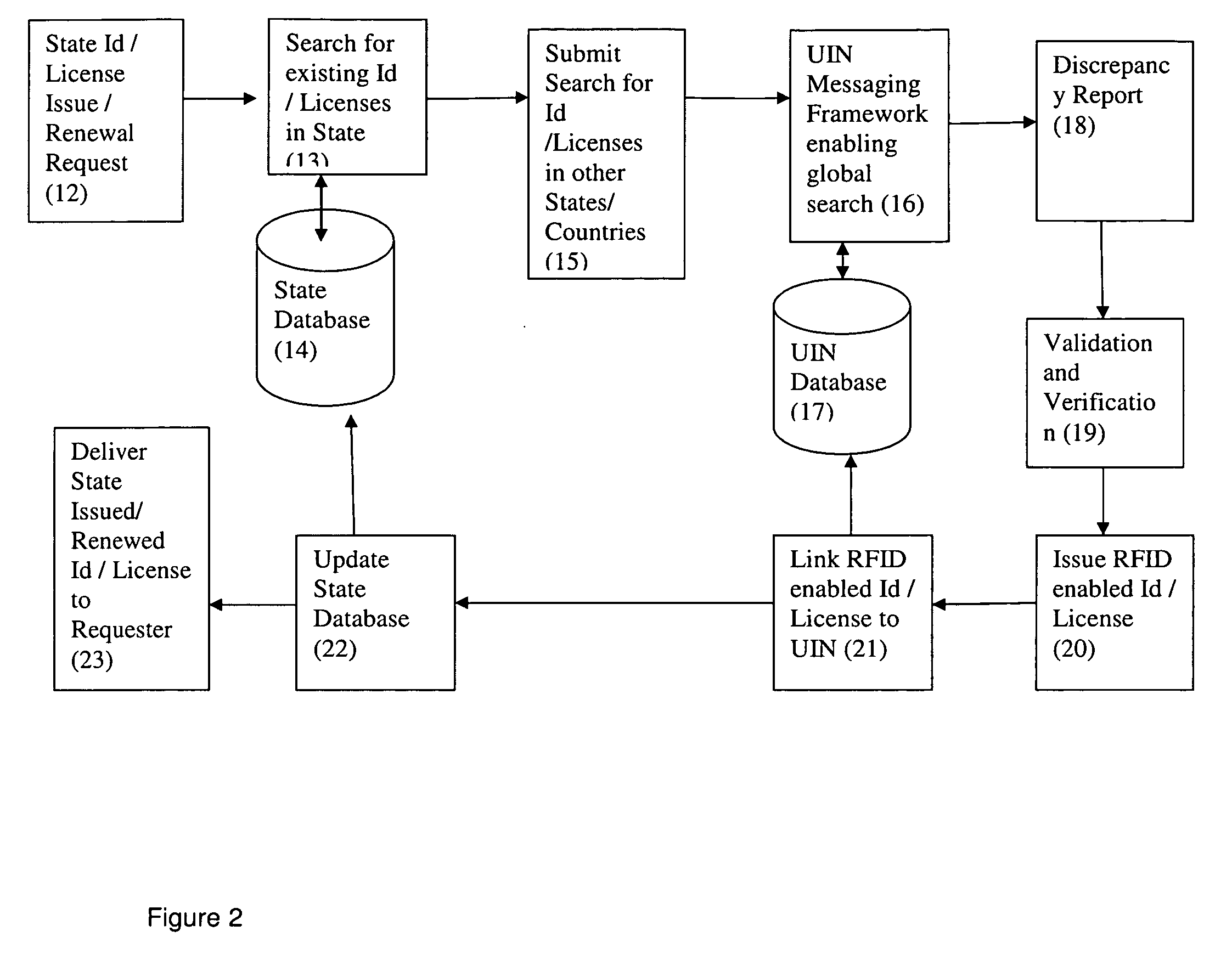

A system and method to generate a Universal Identification Number (UIN) for every human being on the planet, and its RFID application to uniquely verify the identity, and apparatus for biosensor integrated device receiving GPS or cellular signals to determine location, and transmitting data through radio signals to identify, track, monitor, and rescue humans. UIN database comprising of public, health, and confidential data, protects privacy by hiding the sensitive information and providing the required information only to authorized agencies on ‘need to know’ basis, like medical emergency data to authorized hospitals for advance preparedness to save lives or to law enforcement agencies when authorized under specific circumstances. UIN secures credit, debit and ATM card transactions through additional code verification and fulfills a pending need for technological system to eliminate child abduction, identity fraud, credit card theft, terrorism, and helps in saving lives of people.

Owner:AGGARWAL ABHINAV +2

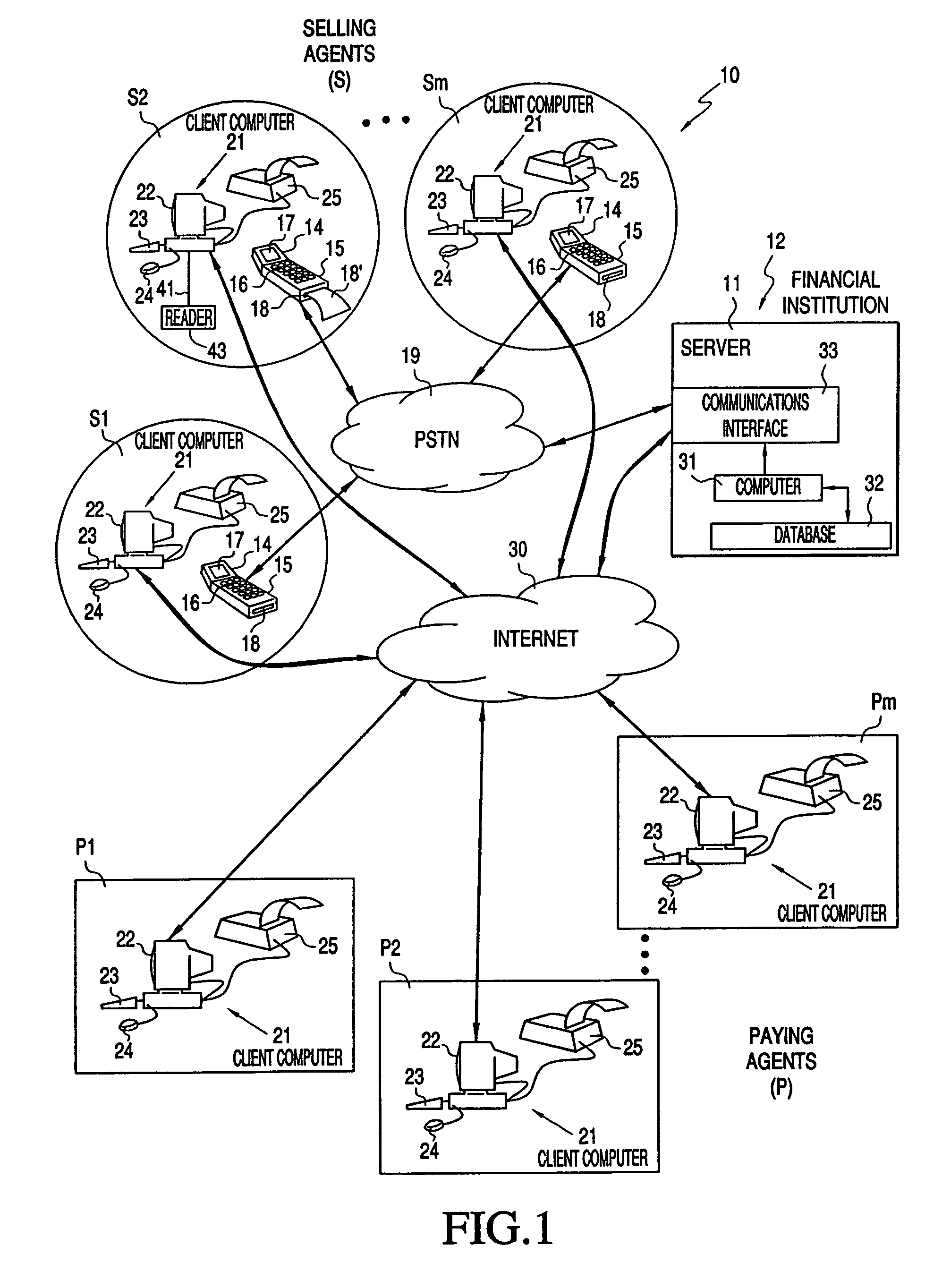

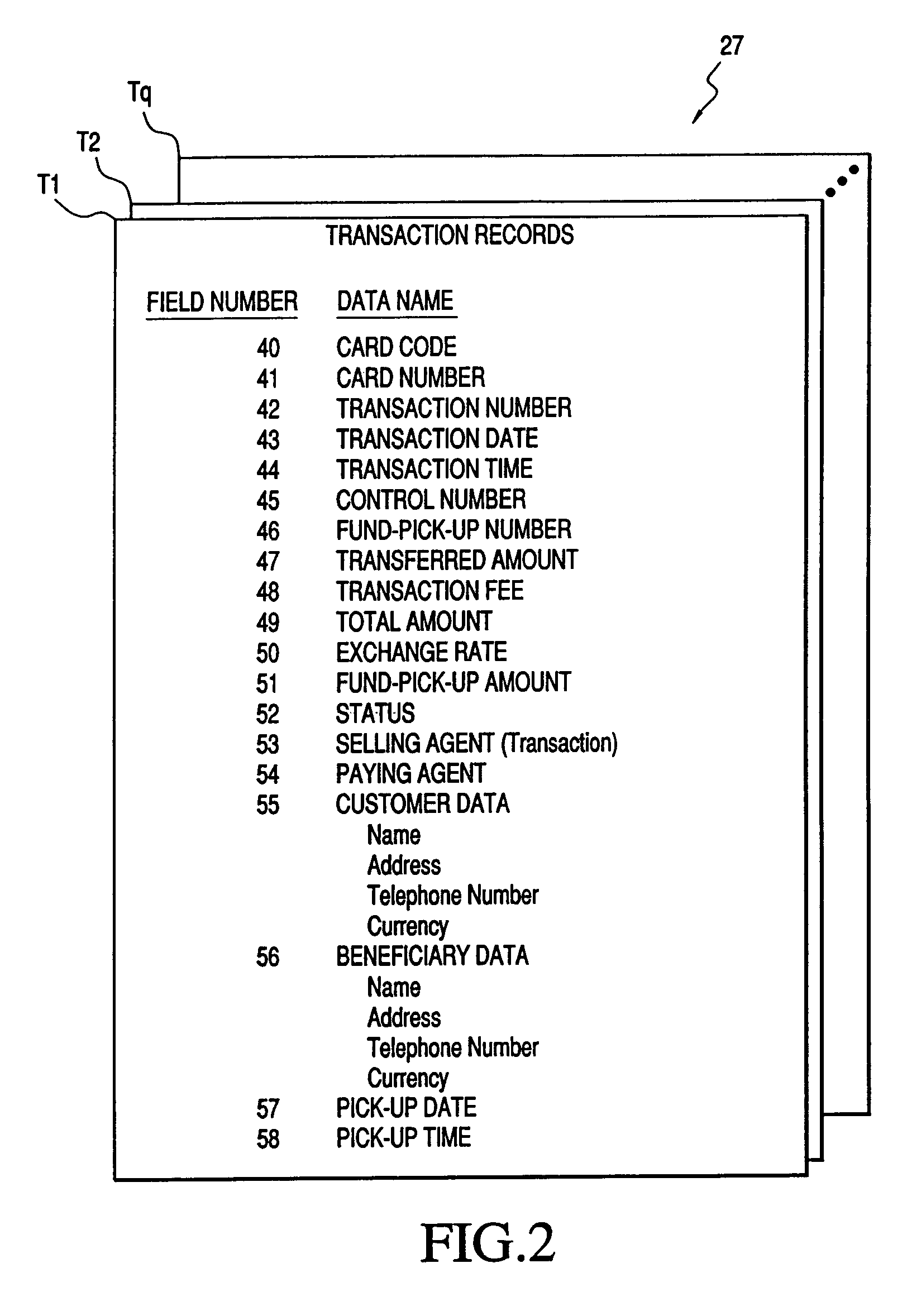

Money-transfer techniques

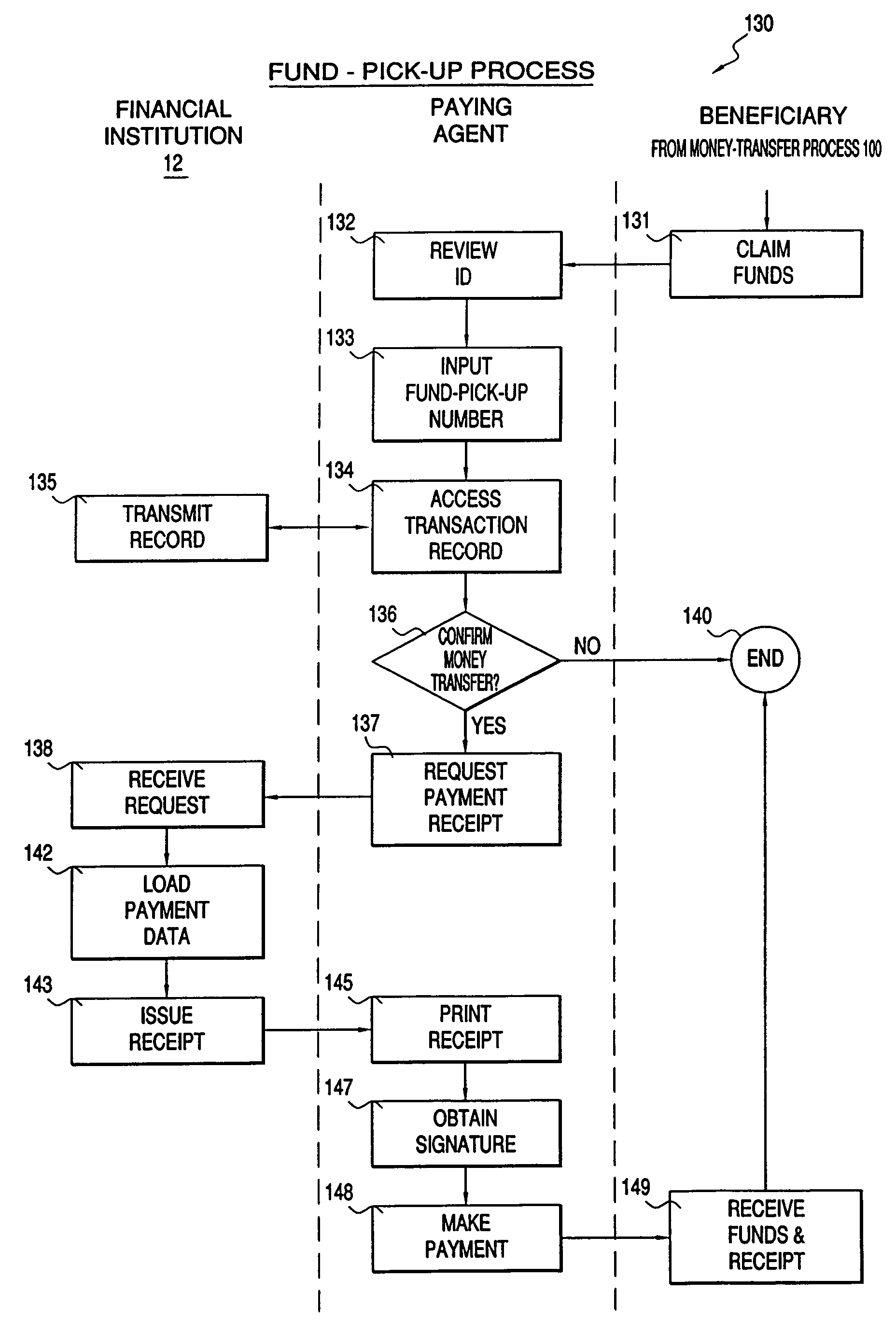

A technique for transferring money between a customer and a beneficiary comprises a financial institution, serving as a money-transfer company, a plurality of selling agents, paying agents and ATM (automatic teller machine) card distributors that communicate via a telephone network and / or the Internet. Selling agents distribute transaction cards to customers for use in initiating a money transfer to a particular beneficiary. A selling agent uses a transaction card to transmit a customer's request to the company, which creates a unique transaction record. The company returns a unique, secret fund pick-up (“folio”) number to the customer. The customer discloses the folio number to the beneficiary, who collects the transferred money. Specifically, the beneficiary may obtain an ATM card from an ATM card distributor and use that card to collect the transferred funds at a conventional ATM.

Owner:UNITELLER FINANCIAL SERVICES

Authentication system for the authorization of a transaction using a credit card, ATM card, or secured personal ID card

InactiveUS20070145121A1Readily affordable for the vendorAcutation objectsPayment architectureCredit cardData information

An authentication system for the authorization of a transaction card, such as a credit card, an ATM card or a secured personal ID card by a user. The authentication system includes a writer authenticator input unit for inputting and encrypting of personal authentication data and information of a user to the transaction card for security purposes. The transaction card is defined to be a credit card, an ATM card or a secured personal ID card. The authentication system further includes a cardholder input unit for the user to insert the transaction card of the user, and a vendor unit for use by a vendor for verifying the personal authentication data information of the user when using the transaction card for completing a transaction. Additionally, the authentication system includes the computer system for inputting encrypted personal data and medical information to the transaction card by the user.

Owner:DALLAL MENASHE FOUAD

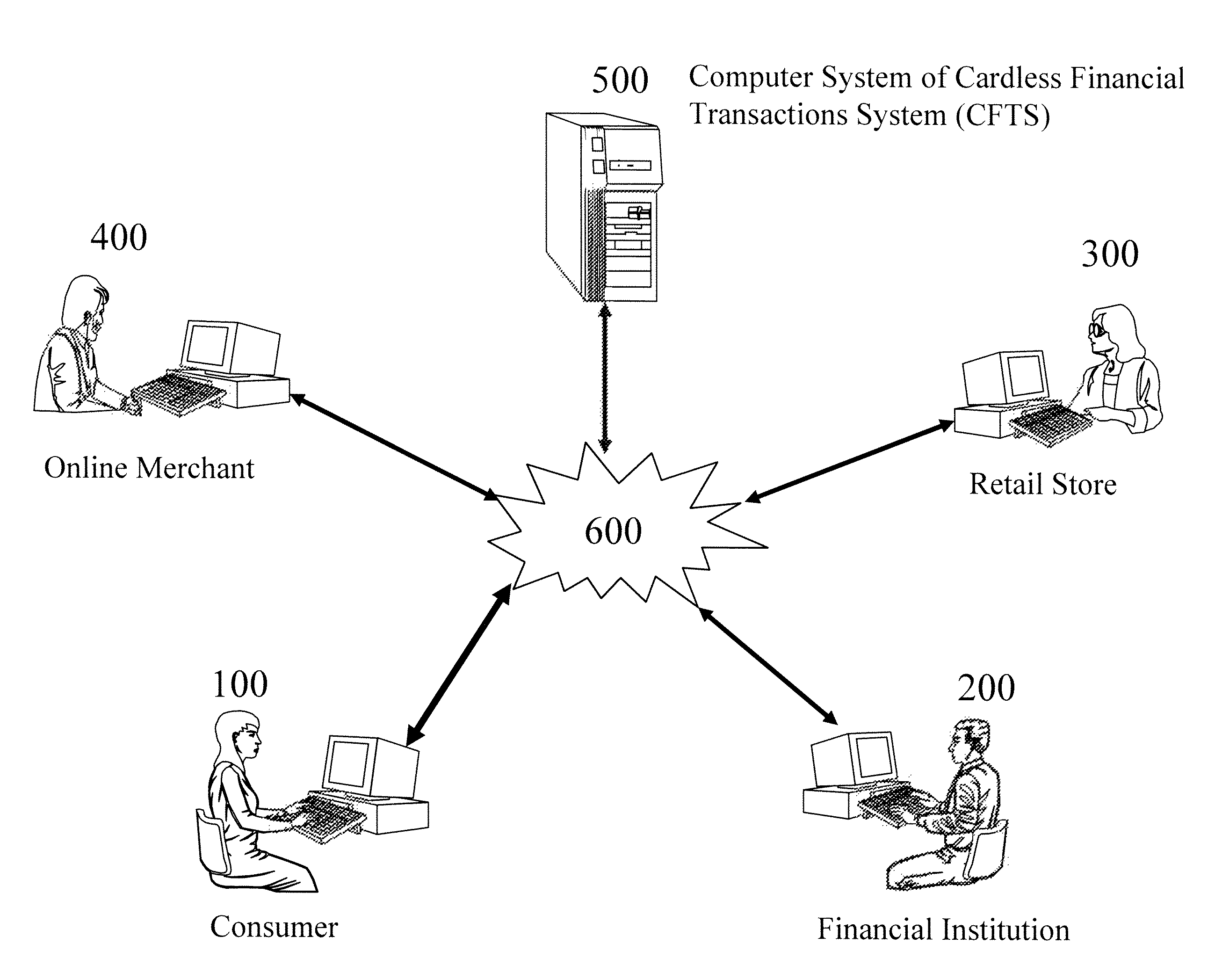

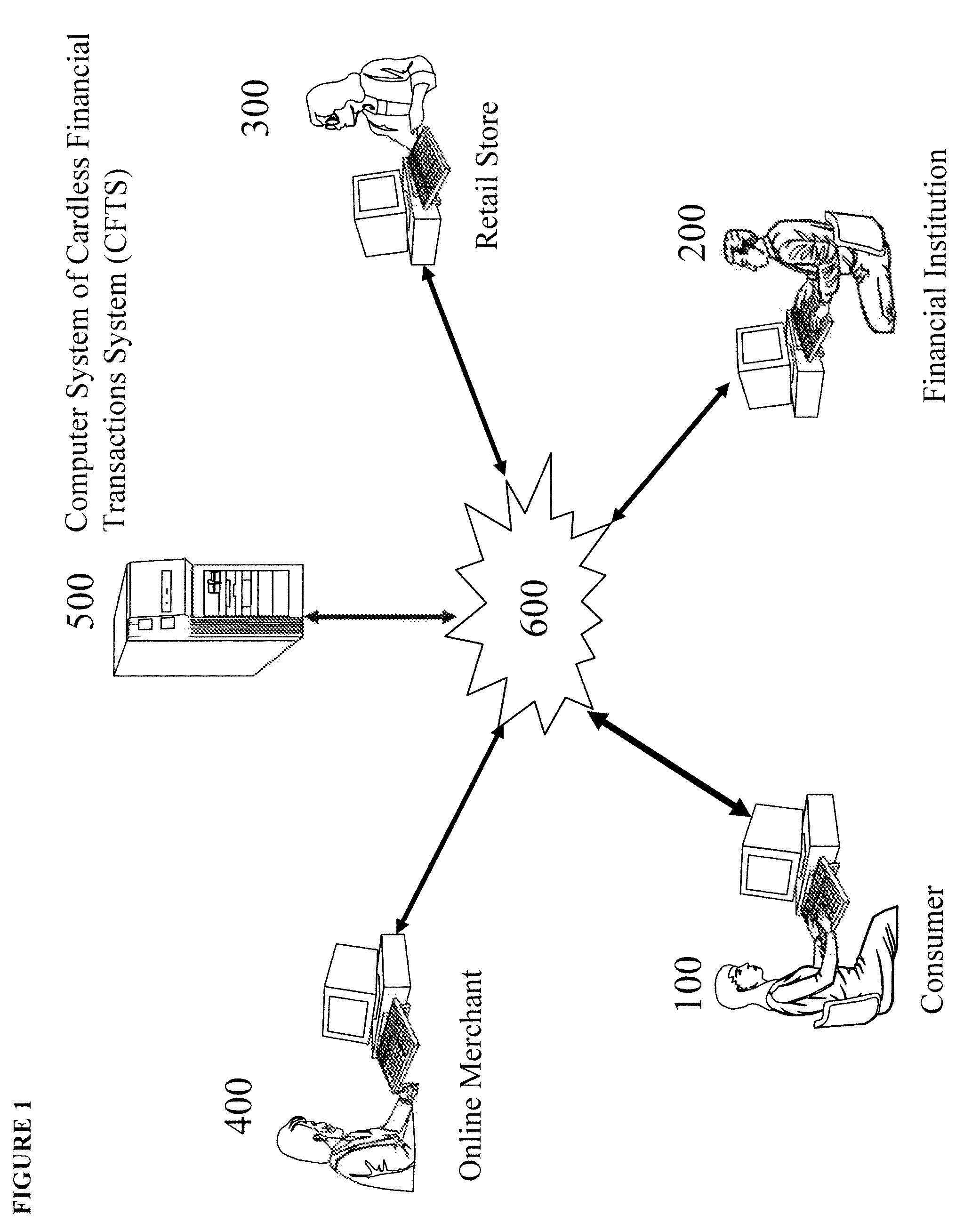

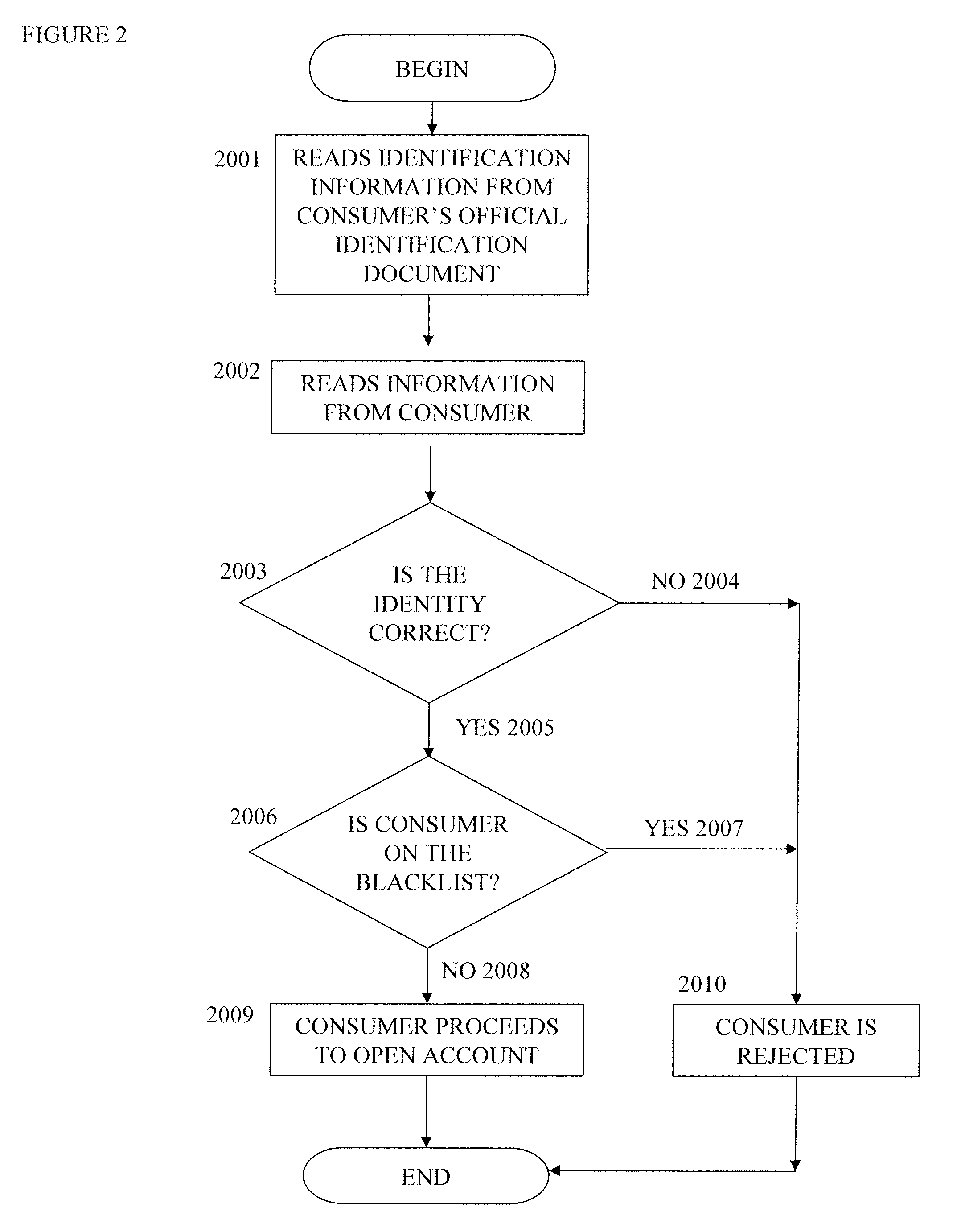

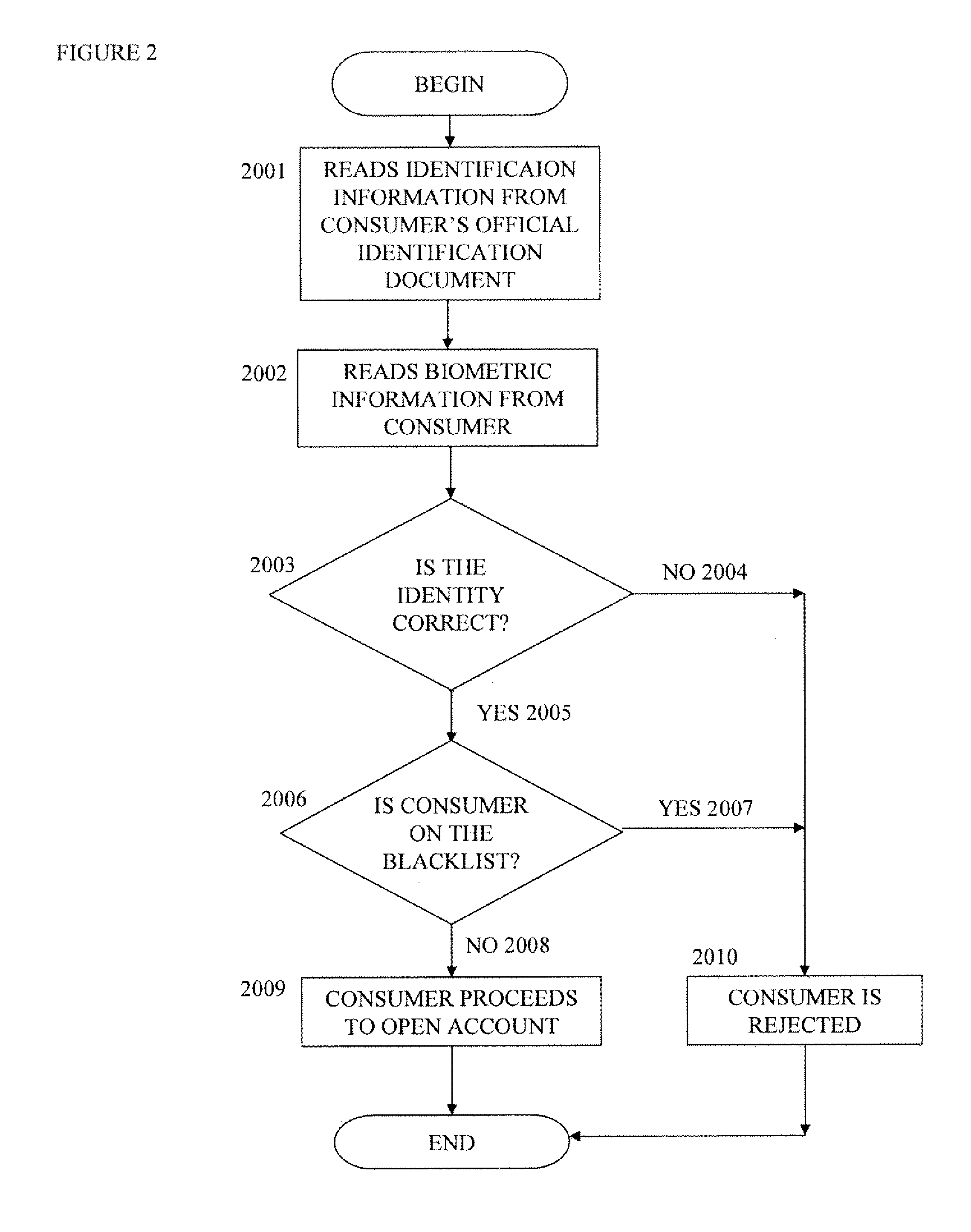

Cardless financial transactions system

ActiveUS8625838B2Preventing financial transactions fraudMinimal effortDigital data processing detailsAnalogue secracy/subscription systemsInternet privacyFinancial transaction

Owner:AI OASIS INC

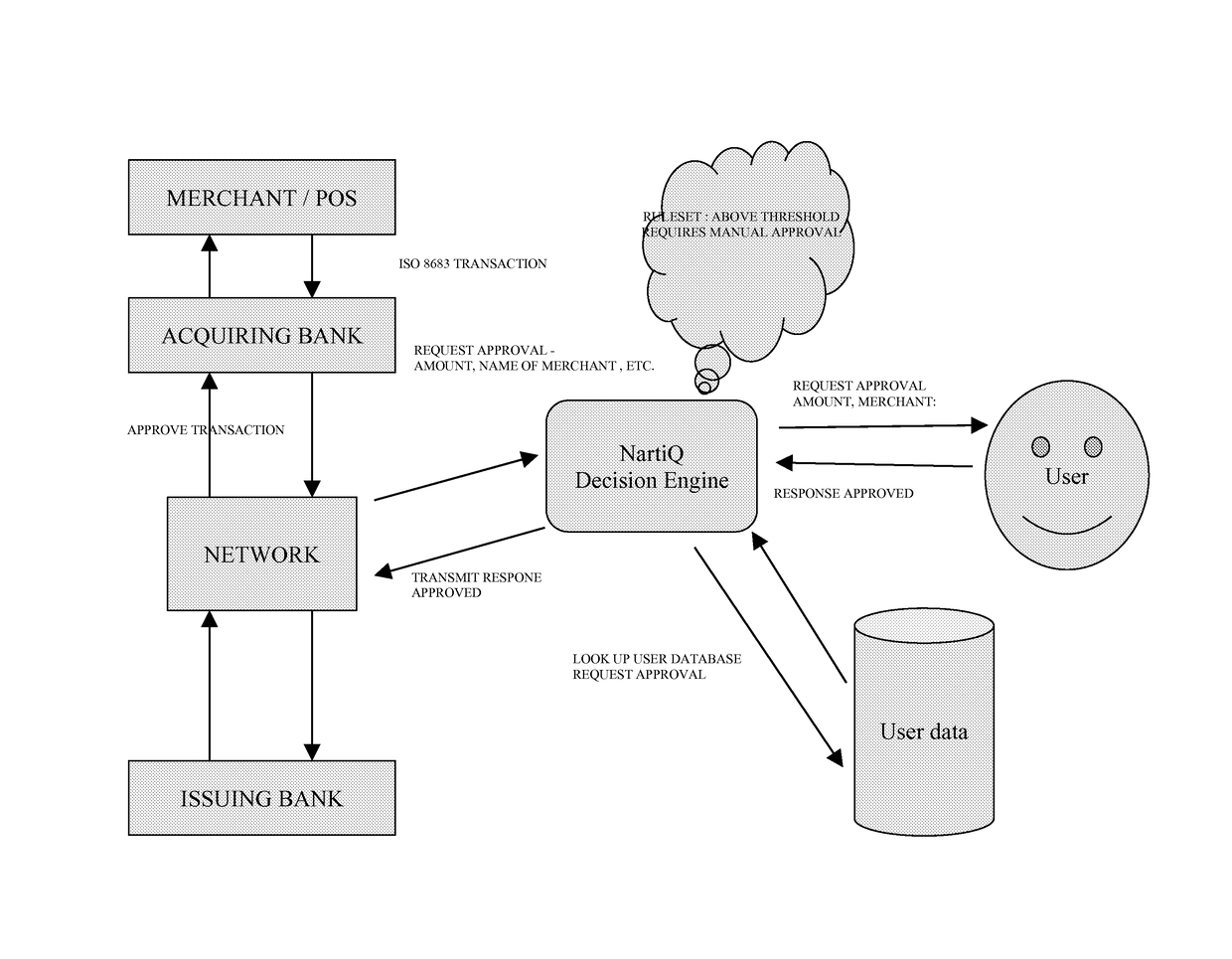

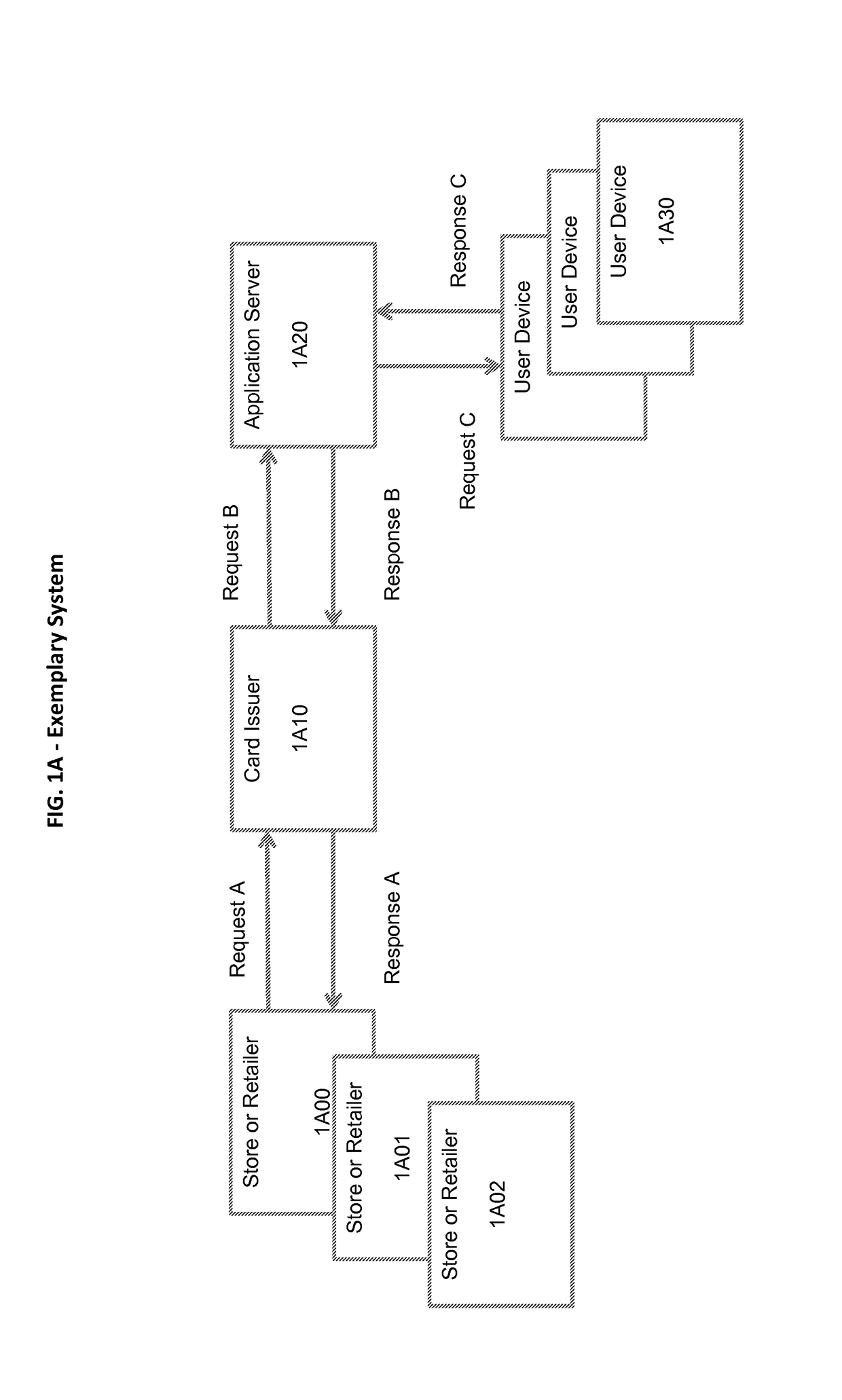

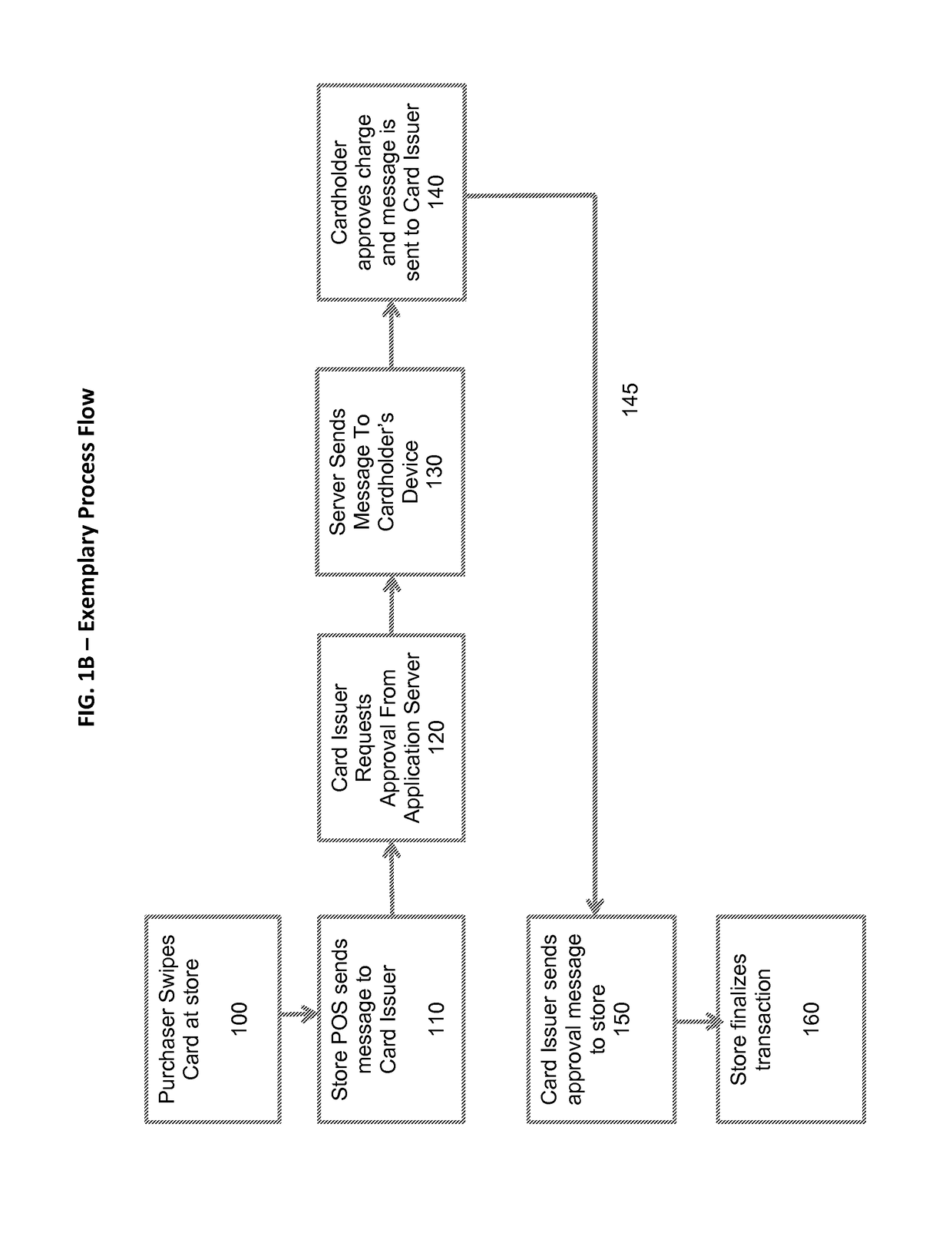

User controlled remote credit and bank card transaction verification system

InactiveUS20170344991A1Illegal useDigital data information retrievalSpecial data processing applicationsCredit cardFood stamps

Systems and methods are presented for preventing the illegal use of credit, ATM or bank cards or the accounts with which they are associated. In exemplary embodiments of the present invention, a user configured approval functionality may be provided that subjects every non-exempted transaction to user approval. A smartphone application may also be provided, in which a user sets and modifies parameters for covered transactions, and may approve or deny any transaction subject to a prior approval requirement. Systems and methods according to the present invention may be applied to cards and similar payment devices of any and all types, including, for example, credit cards, bank cards, ATM cards, retailer specific cards, government issued food stamp or other welfare cards, gift cards, and the like. Thus, a user may register multiple payment cards with such an application, and thus set and modify his or her own criteria (in addition to or in place of default criteria) for flagging transactions made with the cards for approval.

Owner:MARK SHLOMO +1

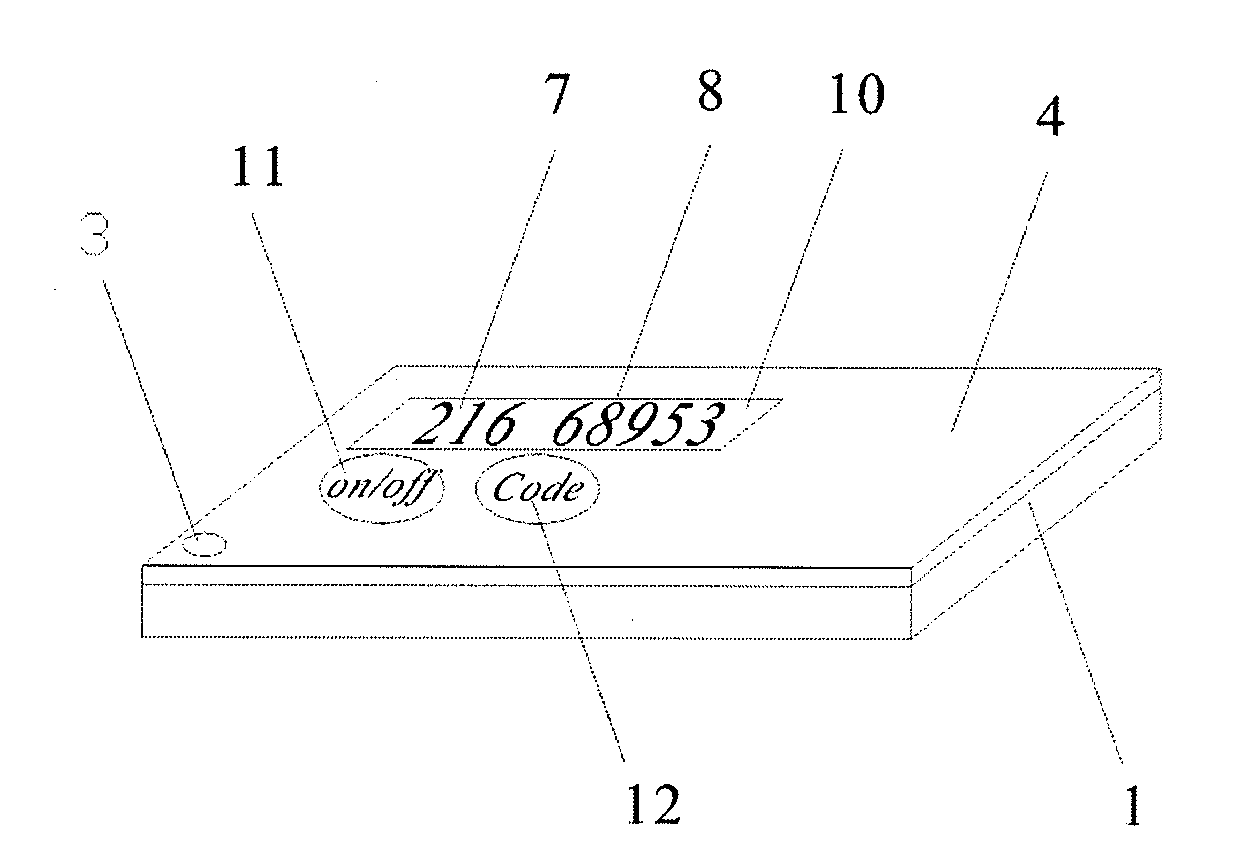

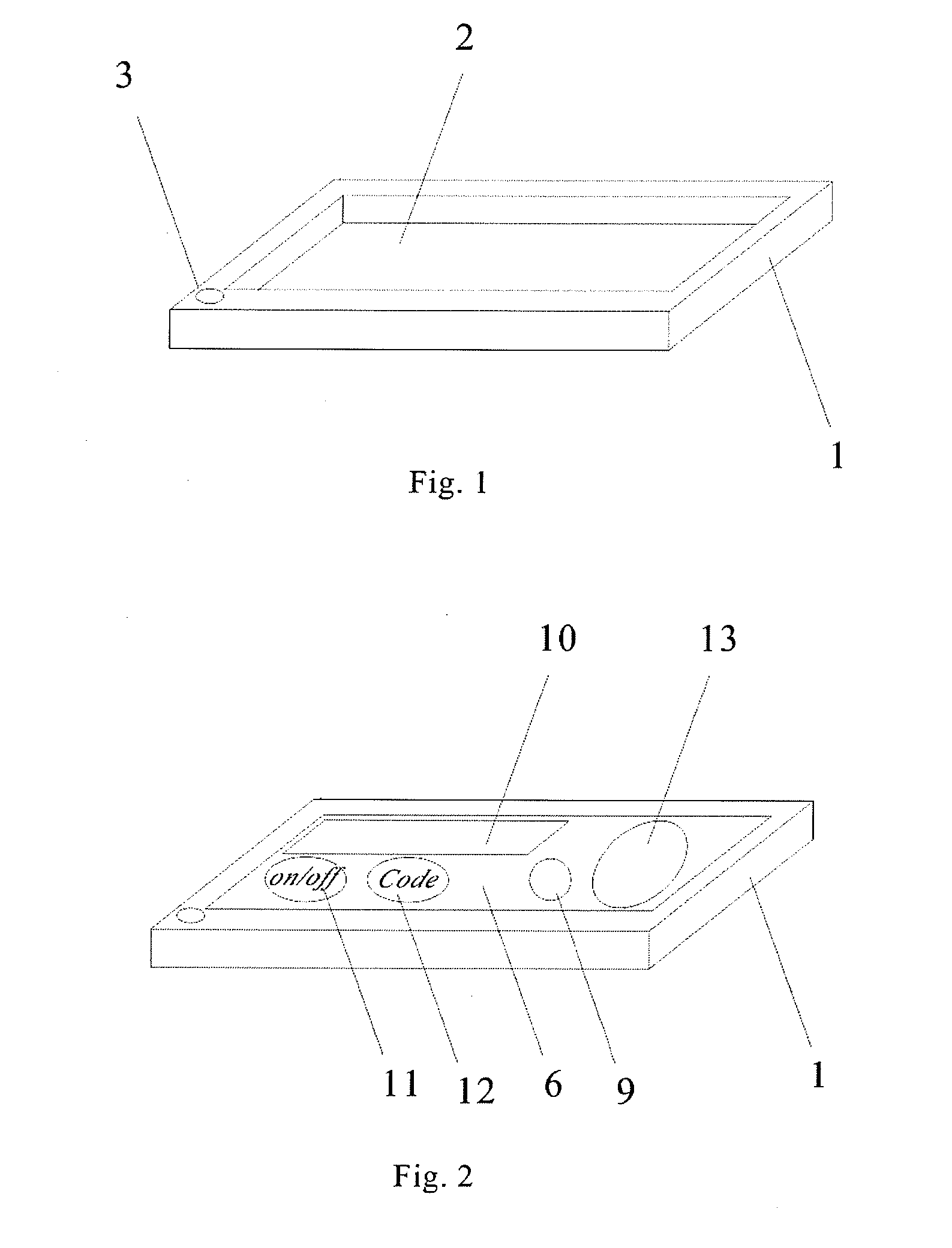

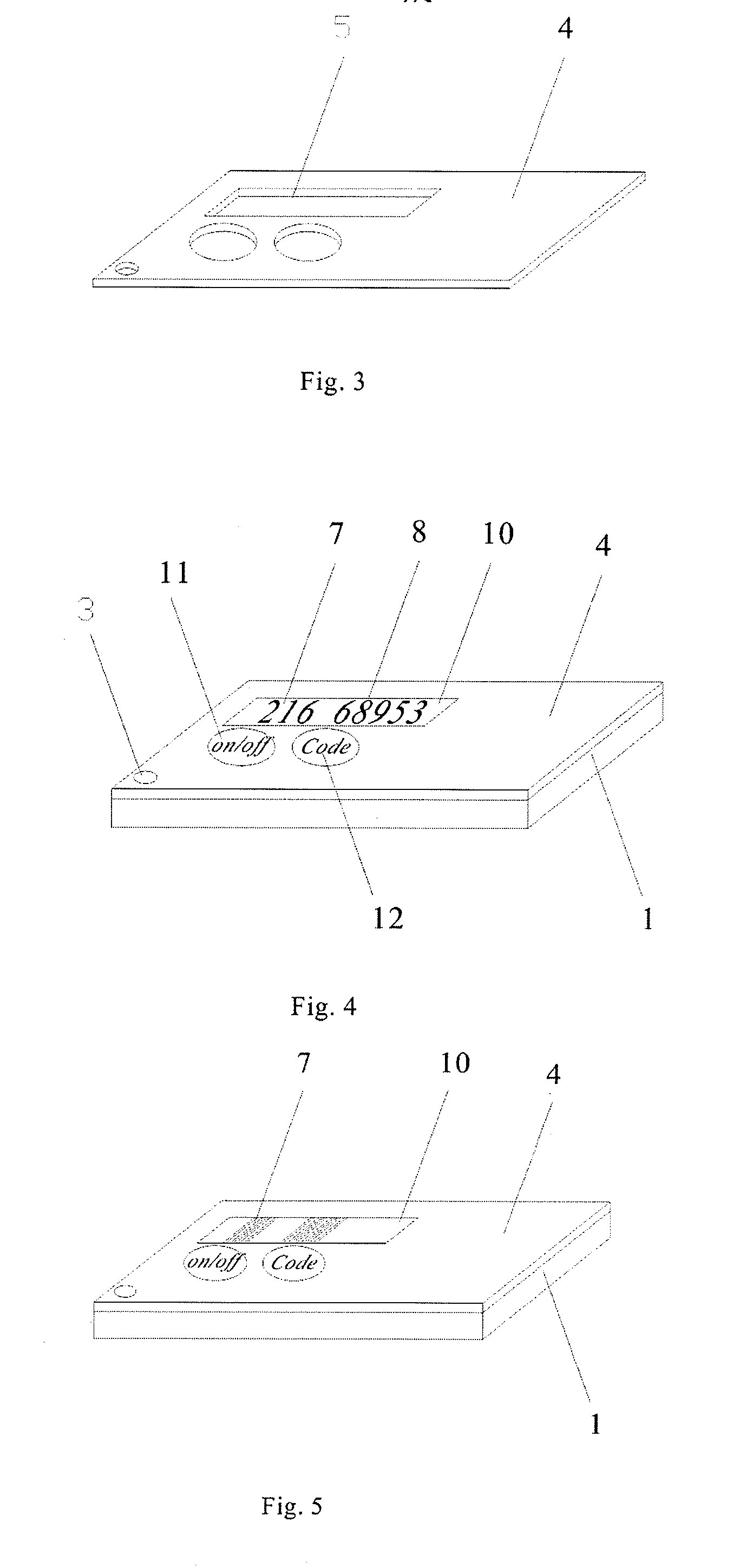

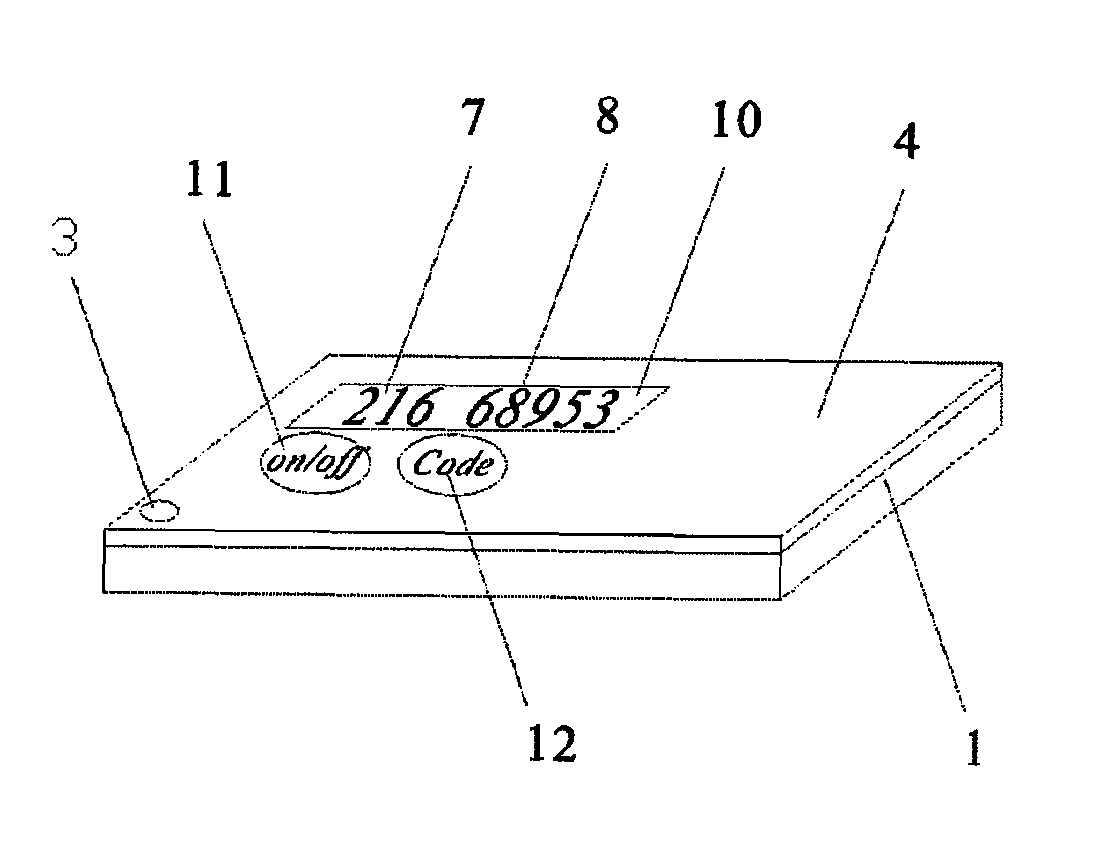

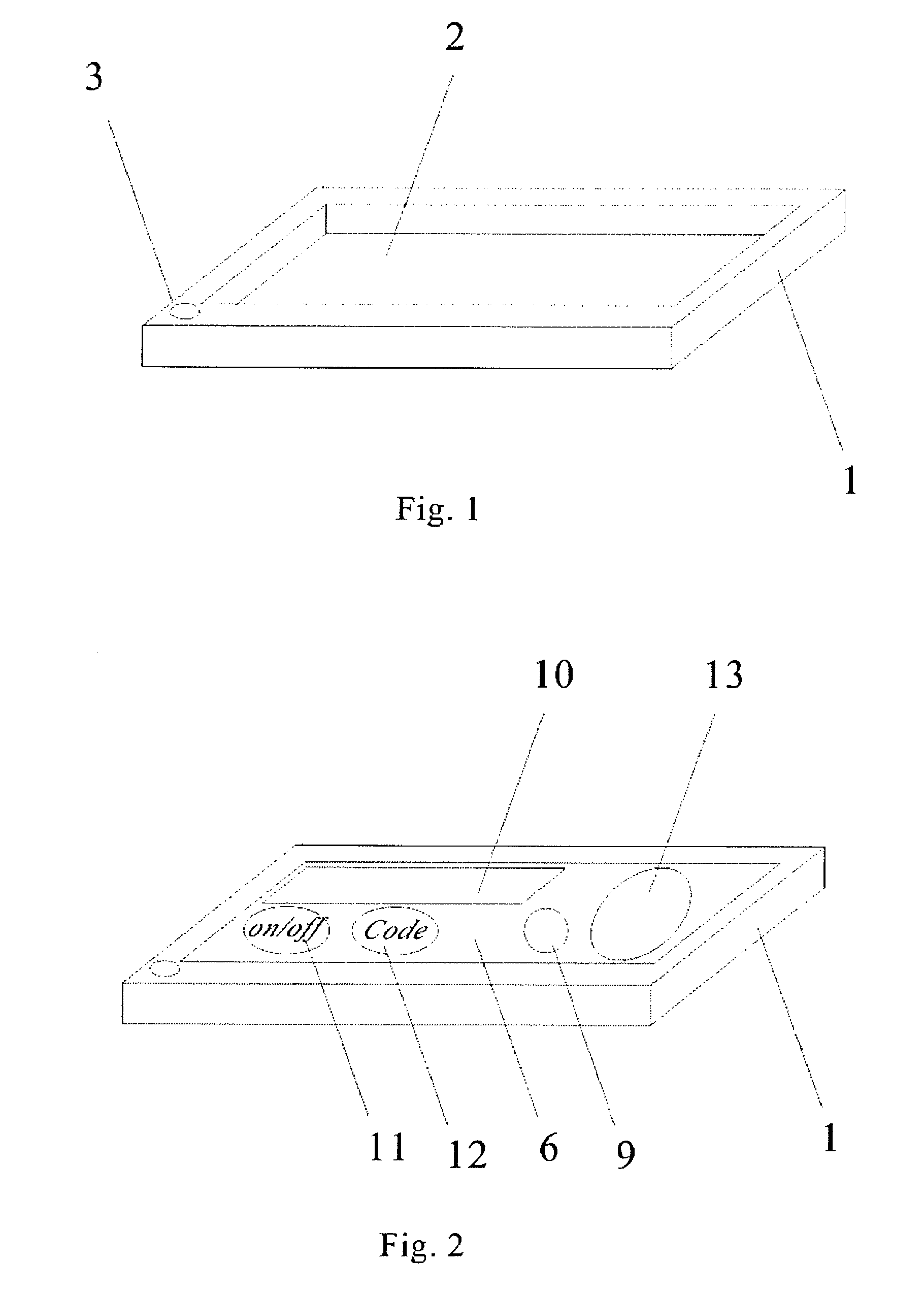

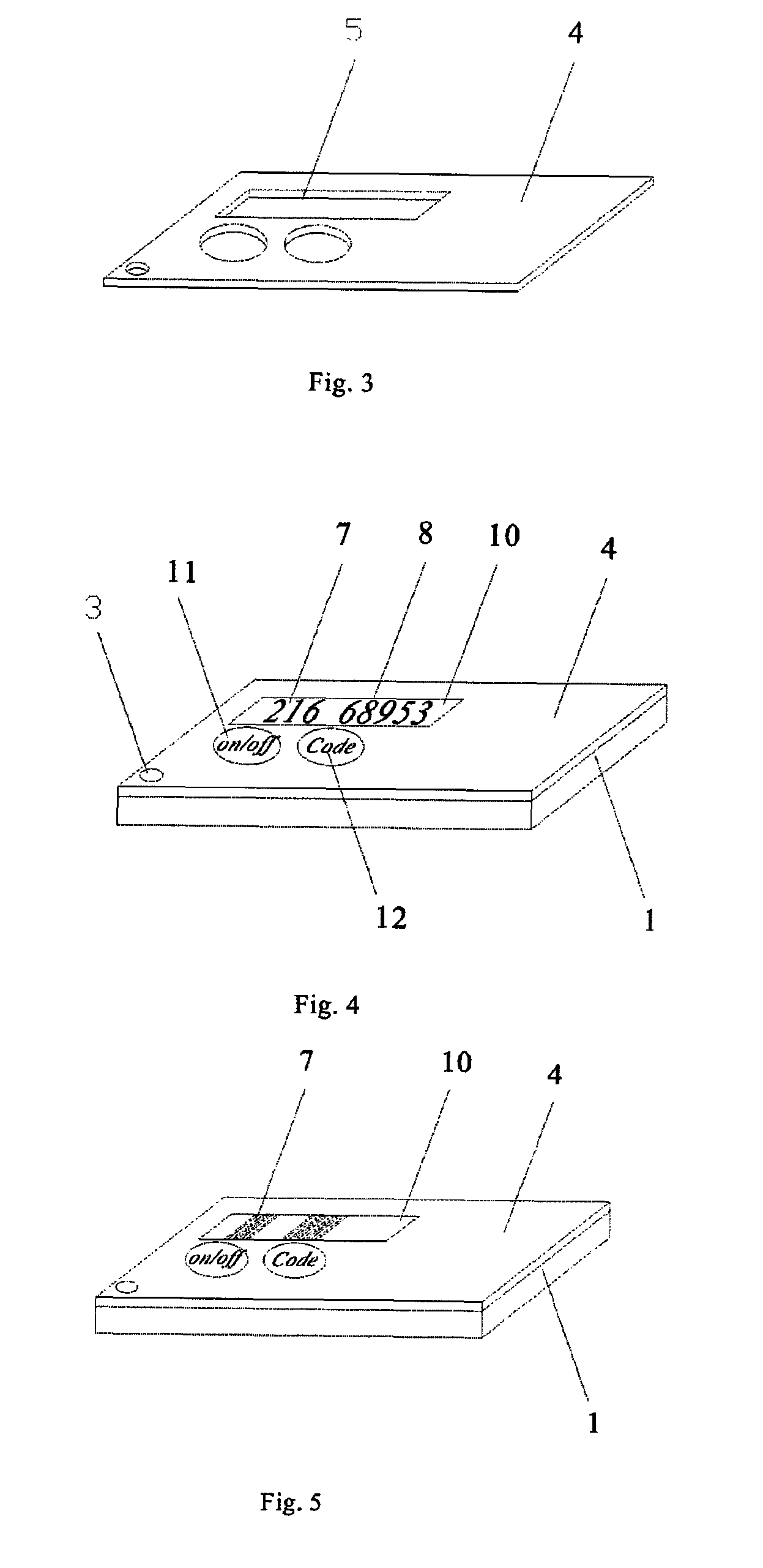

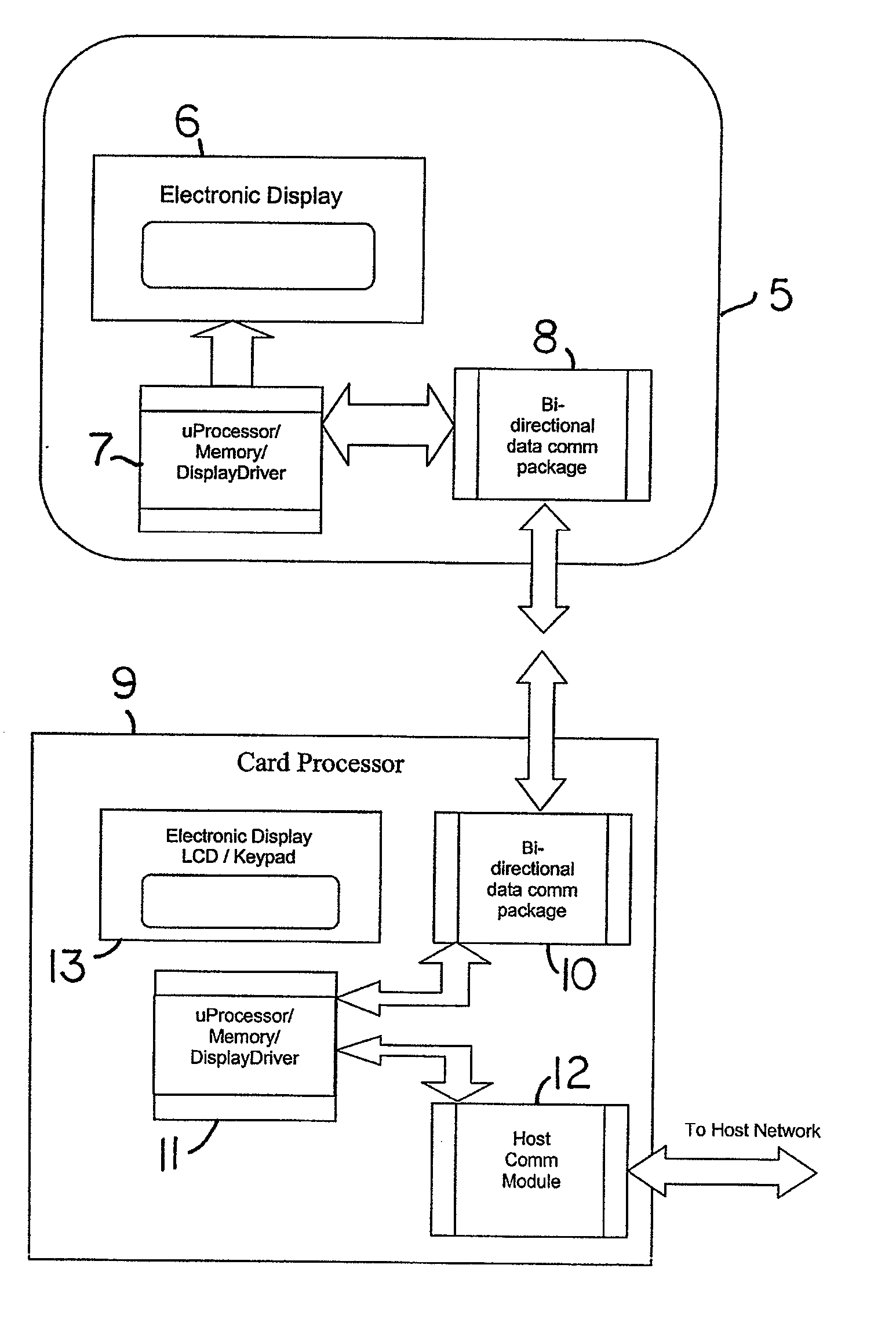

Security Device And Method Incorporating Multiple Varying Password Generator

InactiveUS20090013390A1Low annual feeSmall sizeDigital data processing detailsUser identity/authority verificationComputer hardwareCredit card

A two-varying-password generator having two varying passwords of different digit lengths and different time intervals is disclosed. A two-varying-password generator has a printed circuit board where a processor is soldered onto, a battery, a display window and an on / off key and code key. The processor is loaded with two predetermined programs that can produce two passwords (or more than two passwords) of different digit length and different time interval. When on / off key is pressed, the processor is activated and produces two passwords of the current time using the two predetermined programs loaded in the processor. The two passwords are the functions of time, which are defined by two predetermined programs respectively. Meanwhile, the host computer also stores these two programs in the customer's account. As the clocks of both two-varying-password generator and host computer work in synchronously, both of them can produce two identical passwords of the same moment. Application of two-varying-password generator can counter phishing sites, fight credit card forgery and unauthorized transaction, tackle cloned ATM card. The technique of two-varying-password generator possesses an advantage over competitor's techniques: very low computation load for both host computer and two-varying-password generator. This means that annual fee for each customer is so little that it can be neglected and a two-varying-password generator can be made in very slim size as only a button-size battery is enough to support its 5-year life span.

Owner:LI GONG LING

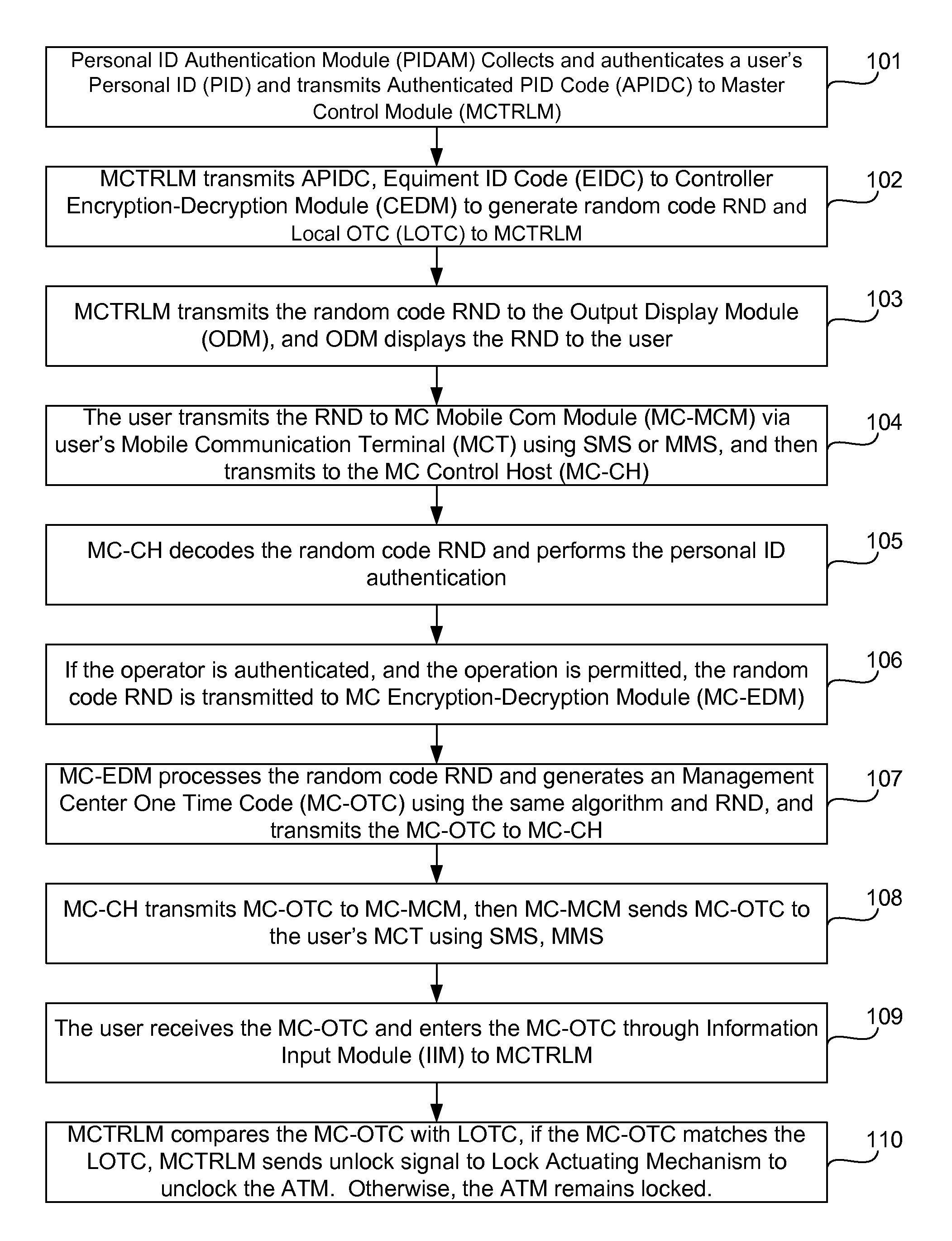

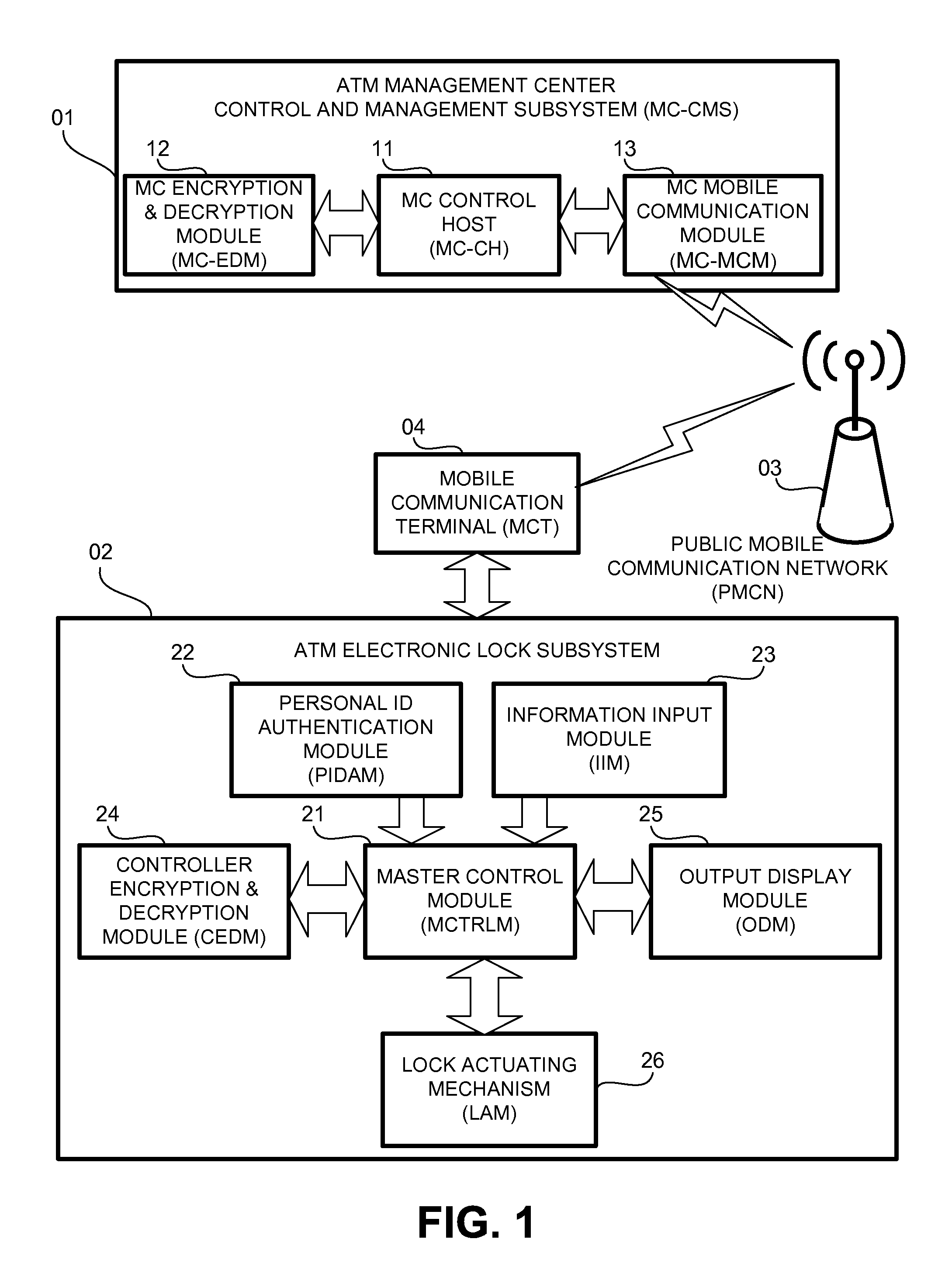

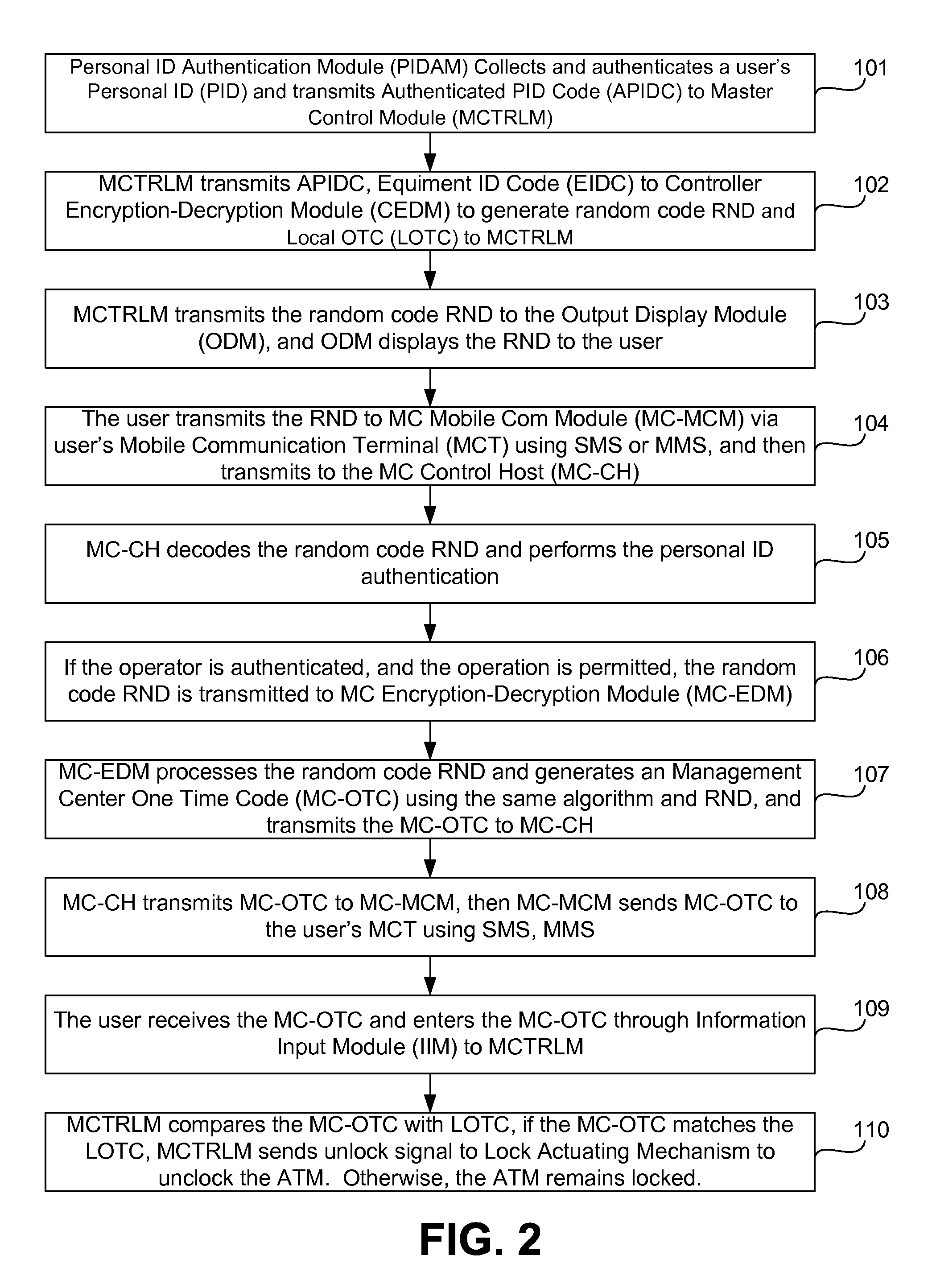

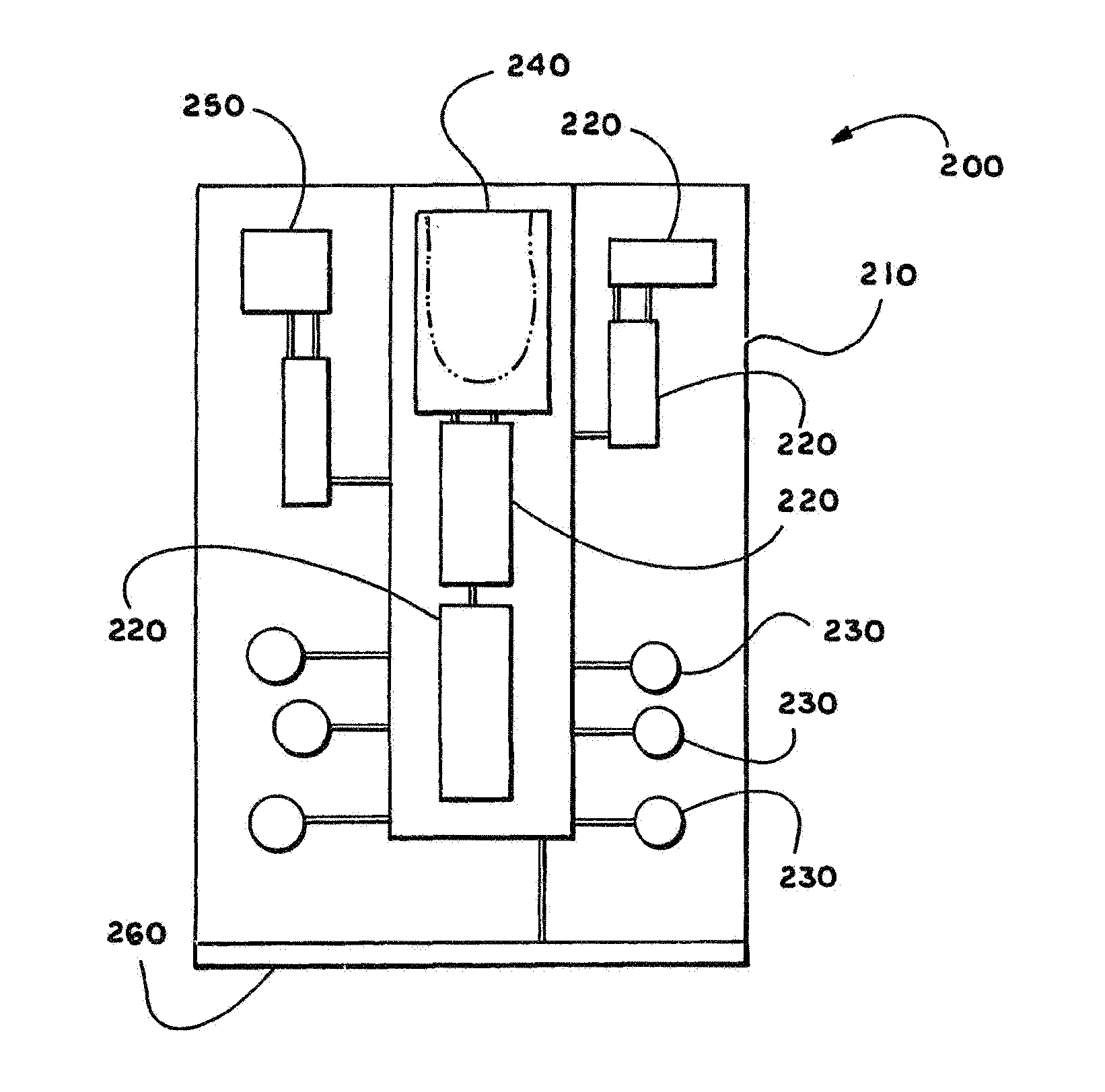

System and method for an ATM electronic lock system

Owner:NANJING EASTHOUSE ELECTRIC CO LTD

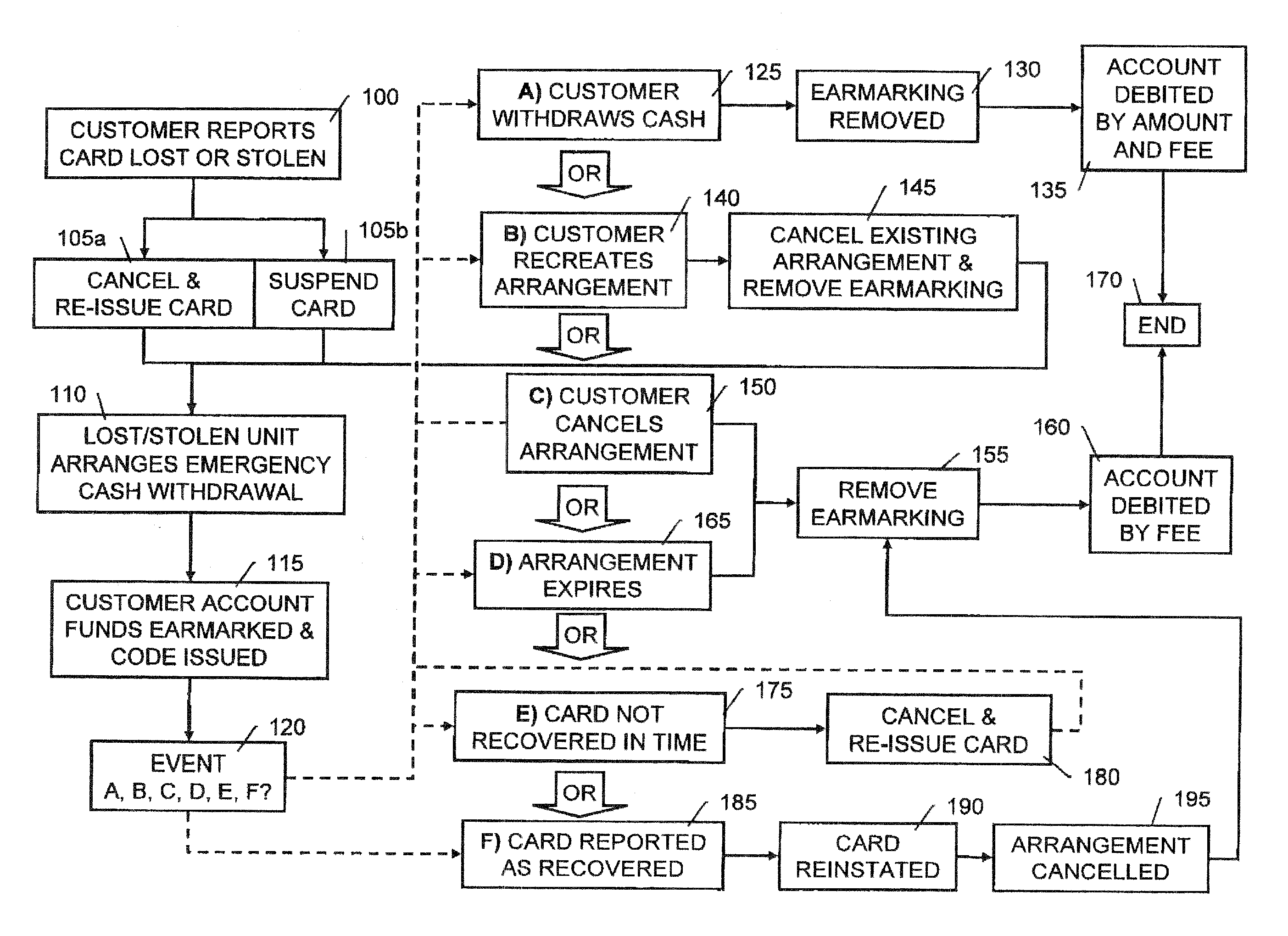

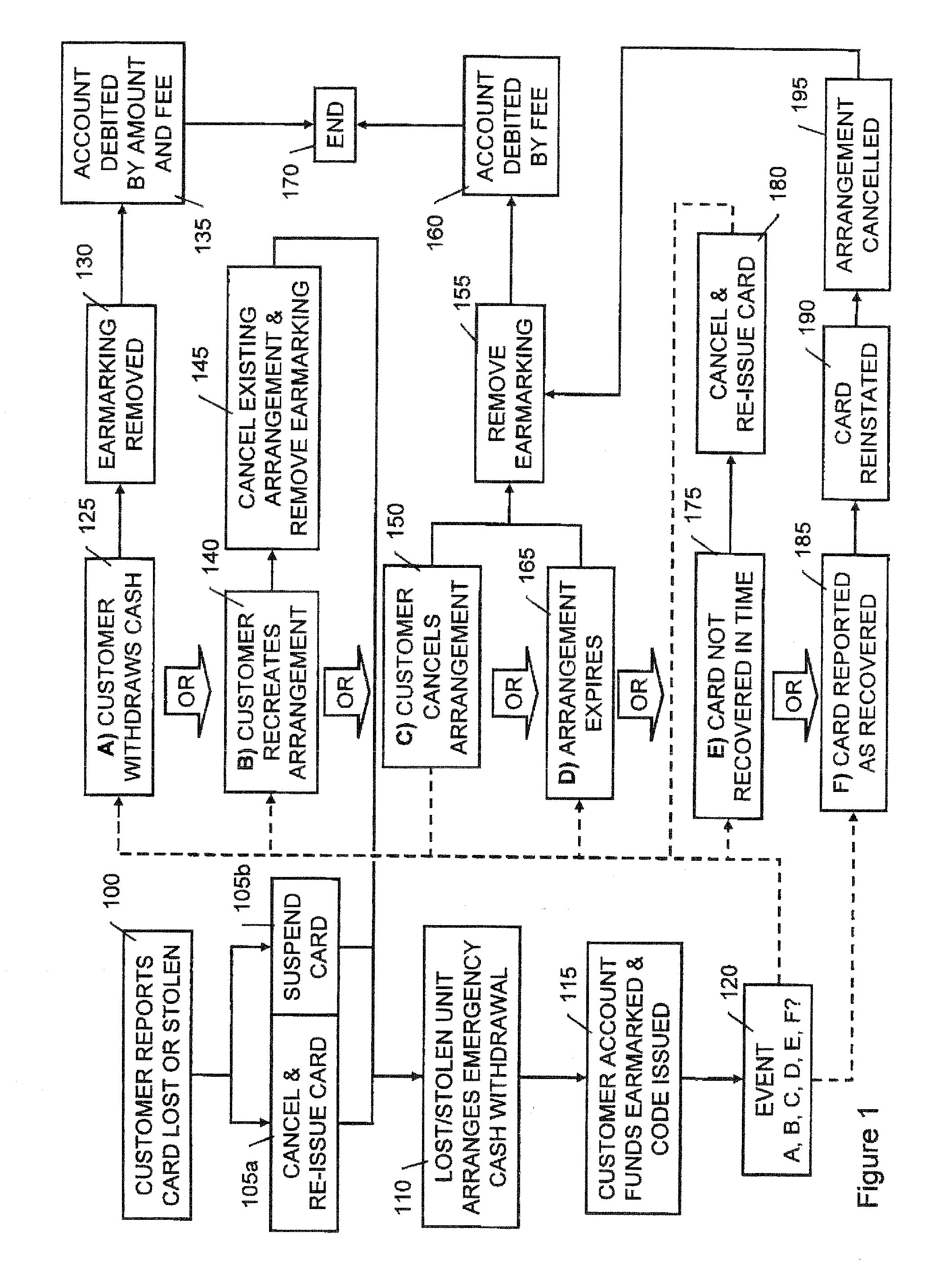

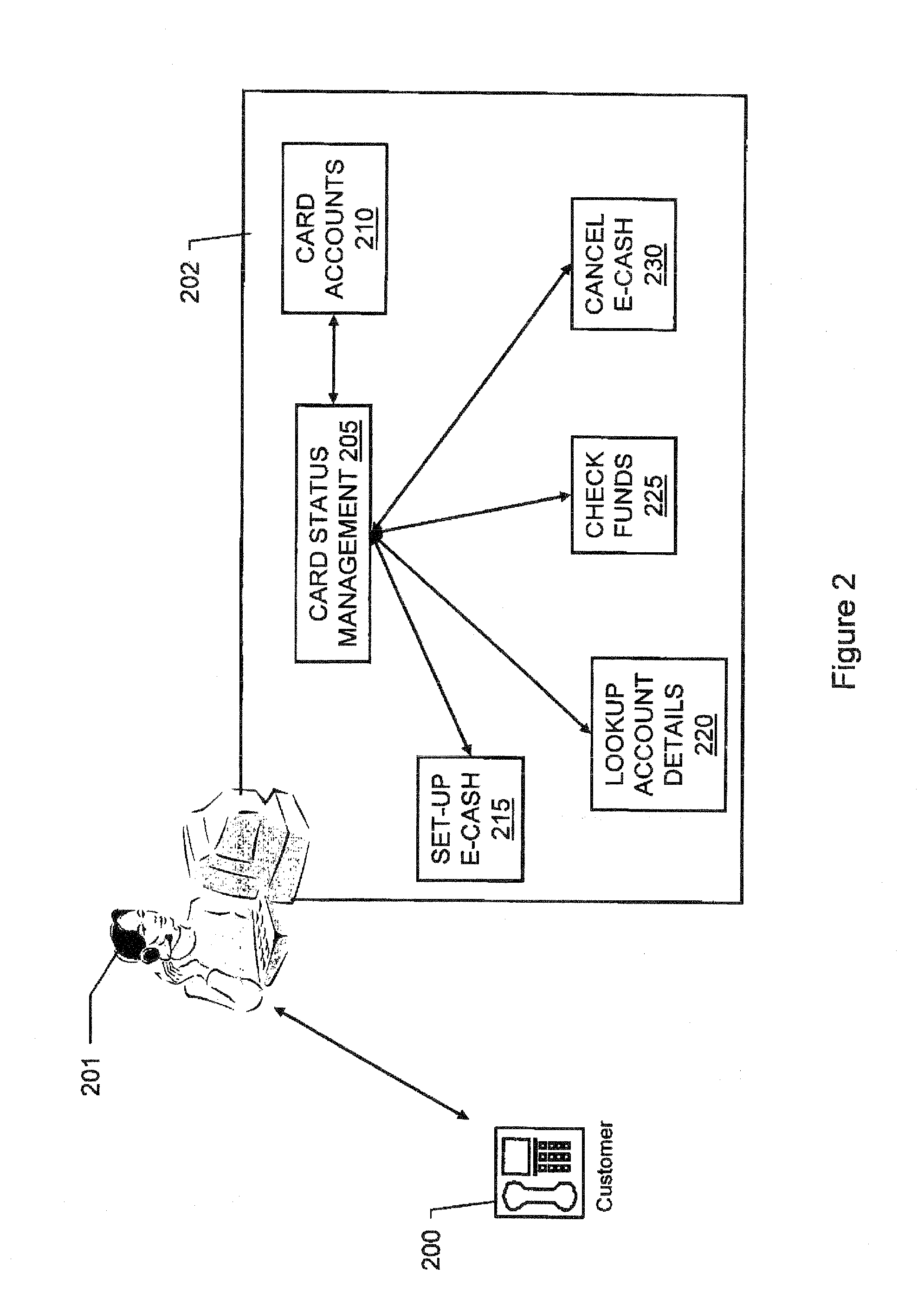

Methods and systems for managing loss or theft of ATM cards

InactiveUS20100145852A1Reduce the possibilityCredit registering devices actuationFinanceATM cardCard holder

Embodiments of the present invention relate to ways of processing the loss or theft of a an ATM card or the like including: reporting to a card provider that the card has been lost or stolen; authenticating the reported loss or theft and restricting the subsequent use of the card; and issuing a cash withdrawal code, which is usable for withdrawing an agreed amount of emergency cash from a cash dispensing machine without•requiring the use of a cash dispensing card, and storing the cash withdrawal code. Embodiments of the present invention thereby enable the card holder to withdraw cash in a situation where they may otherwise be without the facility to obtain cash while limiting or preventing the ability for anyone to misuse the card that has been reported as lost or stolen. Generating of issuing a PIN or code after the card was stolen or loss of said card.

Owner:THE ROYAL BANK OF SCOTLAND PLC

System, method and computer program product for facilitating secure commercial transactions

ActiveUS20120173427A1Minimize necessary data storage capacityAvoid necessityAcutation objectsFinanceComputer hardwarePersonal identification number

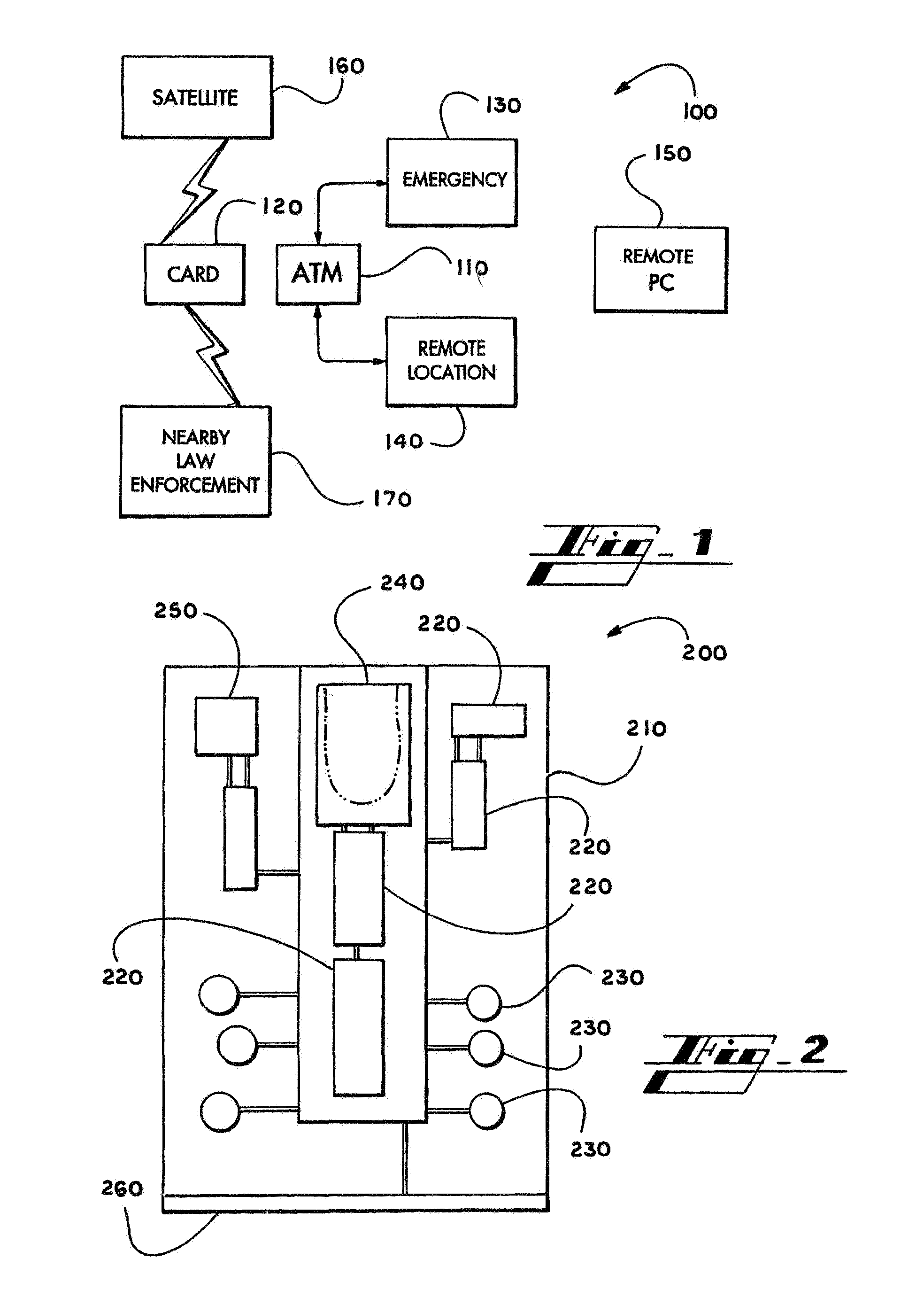

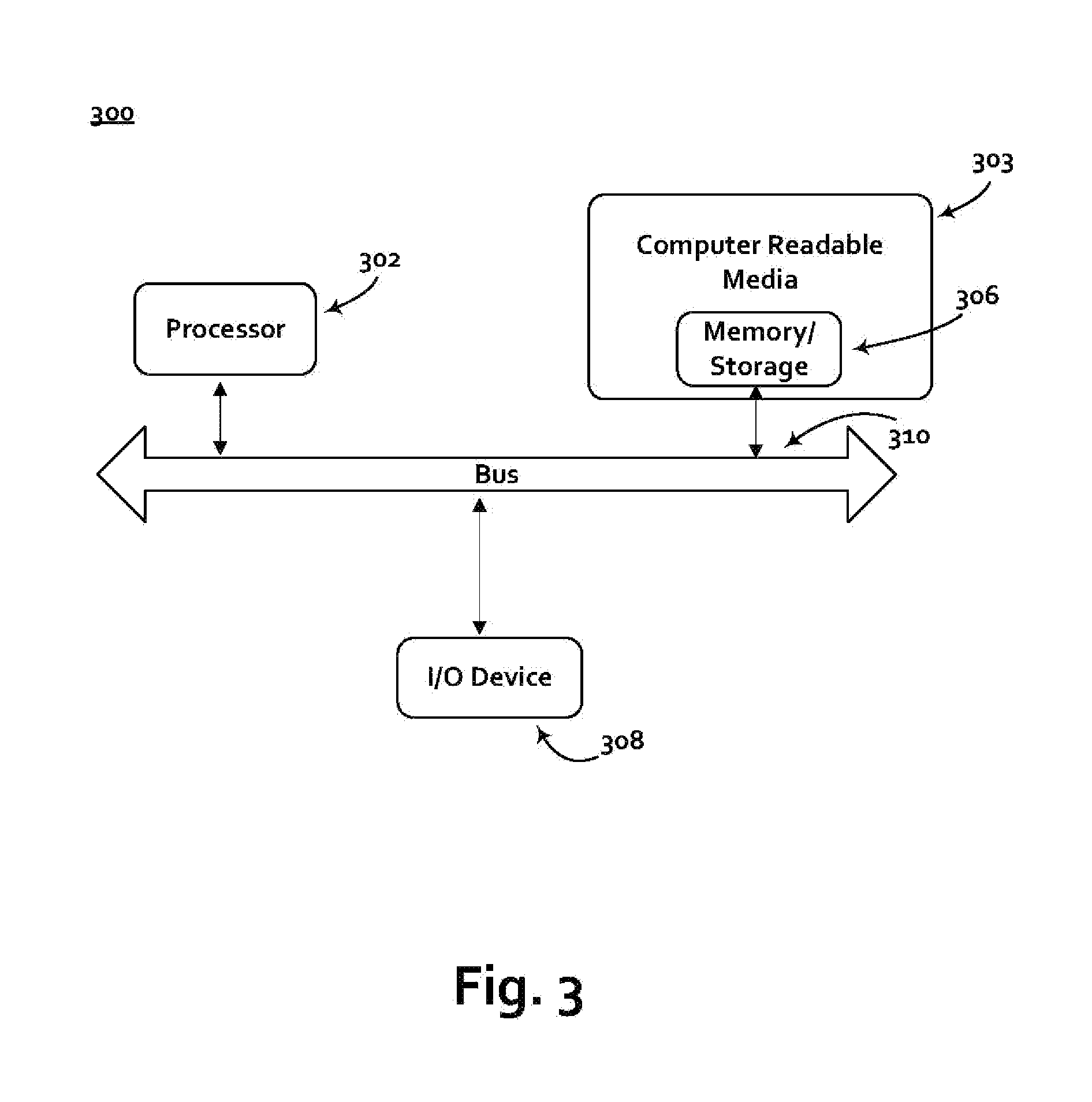

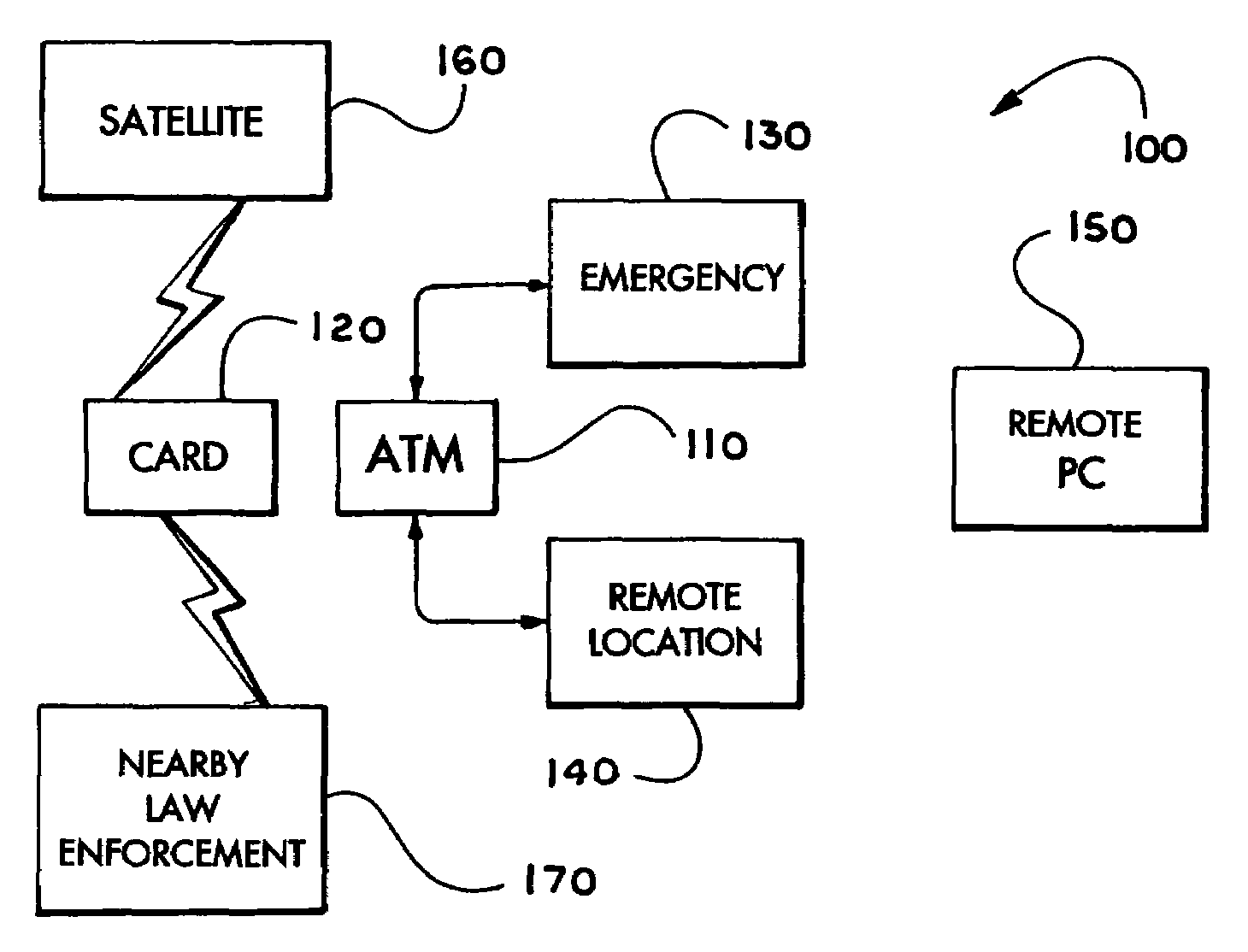

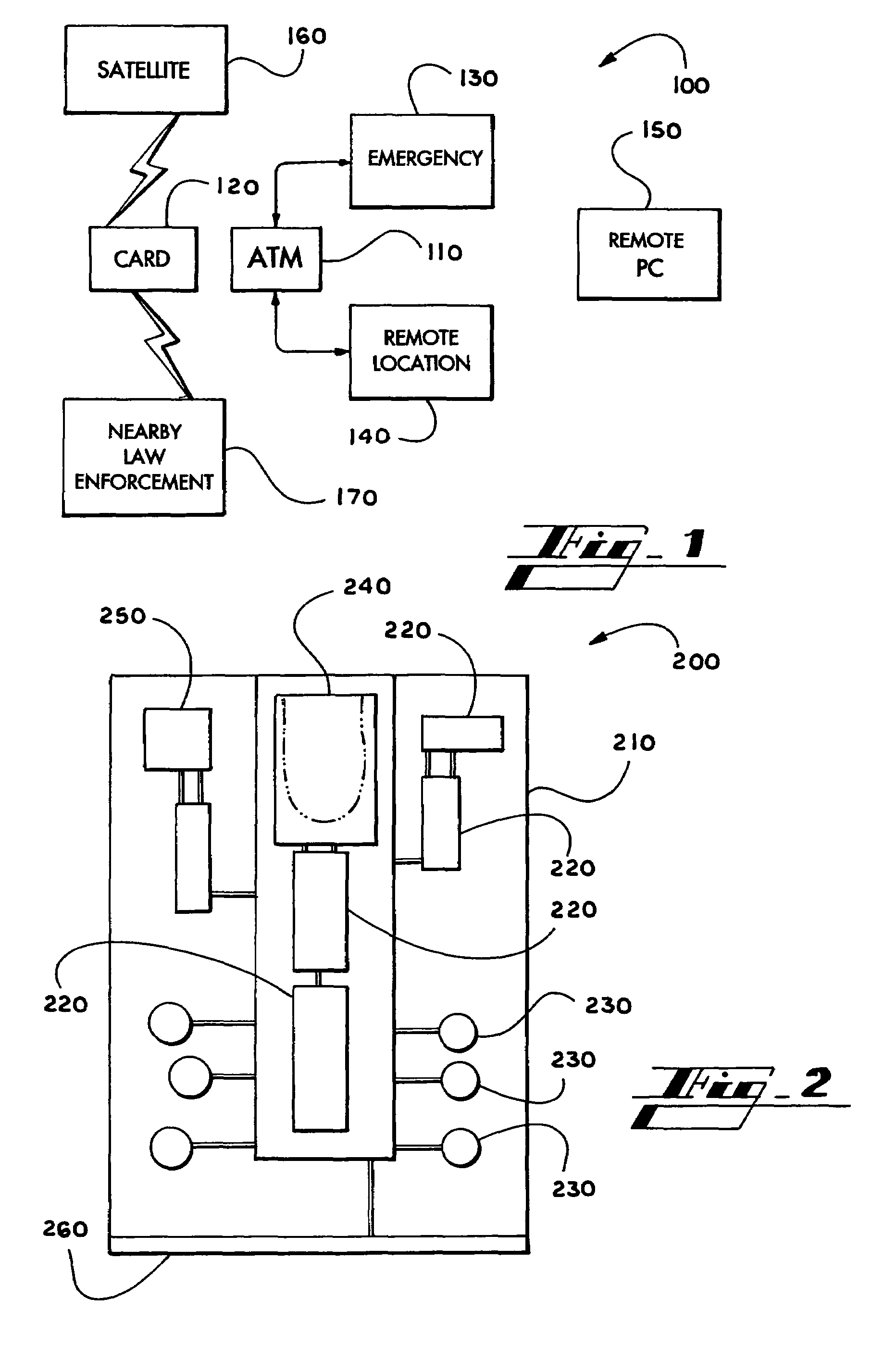

A secure financial transactions system generally includes a card that can be used a credit card, ATM card or debit card having a personal identification number (PIN) that can include a panic digit or panic PIN. The panic digit or panic PIN can be used to begin an emergency notification sequence including sending emergency signals and video transmissions from the commercial transactions machine. The card can include several biometric devices as well as financial transaction records. The card can include data to interact with data gathered from biometric devices on the ATM or POP devices. The card can then be interfaced with a personal computer. The card could also be made into other formats such as a ring, key chain, or other jewelry.

Owner:SPARKS JOHN T

Intelligent IC identification card

InactiveCN101474924ARealize depositRealize withdrawalOther printing matterInformation cardsUser needsComputer hardware

The invention relates to the technical field of an ID card, in particular to an intelligent IC ID card capable of being bound with corresponding systems, such as banks, ticket services and the like. Compared with the prior art, if being bound with a bank system, the intelligent IC ID card has the same function as a bank card; if being bound with a public traffic system, the intelligent IC ID card has the same function as a bus card; and if being bound with a ticket service system, the intelligent IC ID card can realize ticket ordering and ticket purchasing in actual names. Thus, the intelligent IC ID card not only can realize effective identification of the identity, but also can be used as various ATM cards, payment cards and consumption cards so as to realize an all-purpose card which is general in the whole country and bring great convenience for users. The ID card solves the problems that the users take the card by mistake because of carrying multiple cards so as to cause the phenomenon of retaining the cards, the codes of multiple cards can be easily mixed so as to cause the phenomenon of forgetting the codes, and various cards are stored together to cause the phenomenon of mixing magnetism or losing magnetism; and the users need to show corresponding ID cards on occasions of real-name purchasing tickets, and the like.

Owner:庄秀宝

Paperless Coupon Transactions System

PendingUS20110225045A1Easily fabricatedEasy to be stolenFinanceDigital data authenticationInternet privacyFinancial transaction

Owner:SONG YUH SHEN +3

Secure commercial transactions system

A secure financial transactions system. The system generally includes a card that can be used a credit card, ATM card or debit card having a personal identification number (PIN) that can include a panic digit or panic PIN. The panic digit or panic PIN can be used to begin an emergency notification sequence including sending emergency signals and video transmissions from the commercial transactions machine. The card can include several biometric devices as well as financial transaction records. The card can include data to interact with data gathered from biometric devices on the ATM or POP devices. The card can then be interfaced with a personal computer. The card could also be made into other formats such as a ring, key chain, or other jewelry.

Owner:SPARKS JOHN T

Security device and method incorporating multiple varying password generator

InactiveUS8200978B2Small sizeLow annual feeDigital data processing detailsUser identity/authority verificationCredit cardComputer hardware

A two-varying-password generator having two varying passwords of different digit lengths and different time intervals is disclosed. A two-varying-password generator has a printed circuit board where a processor is soldered onto, a battery, a display window and an on / off key and code key. The processor is loaded with two predetermined programs that can produce two passwords (or more than two passwords) of different digit length and different time interval. Meanwhile, the host computer also stores these two programs in the customer's account. As the clocks of both two-varying-password generator and host computer work in synchronously, both of them can produce two identical passwords of the same moment. Application of two-varying-password generator can counter phishing sites, fight credit card forgery and unauthorized transaction, tackle cloned ATM card.

Owner:LI GONG LING

Incentive imaging methods and devices

A method of providing incentives to customers which involves providing customers with cards having changeable display areas. During a transaction, the cards are received from the customers and an incentive image is displayed on the display areas of the cards when they are returned to the customers. The incentive images can be coupons, discount certificates, or other marketing or promotional offerings, prize notifications, loyalty rewards, etc. The cards can be credit cards, including gift cards, debit cards, ATM cards, shoppers' cards, merchants' cards, phone cards, casino cards, or any other similar cards. A transaction card that displays updated value balances on the card and a system for performing the value updates is also disclosed.

Owner:NIXON LANE KAREN

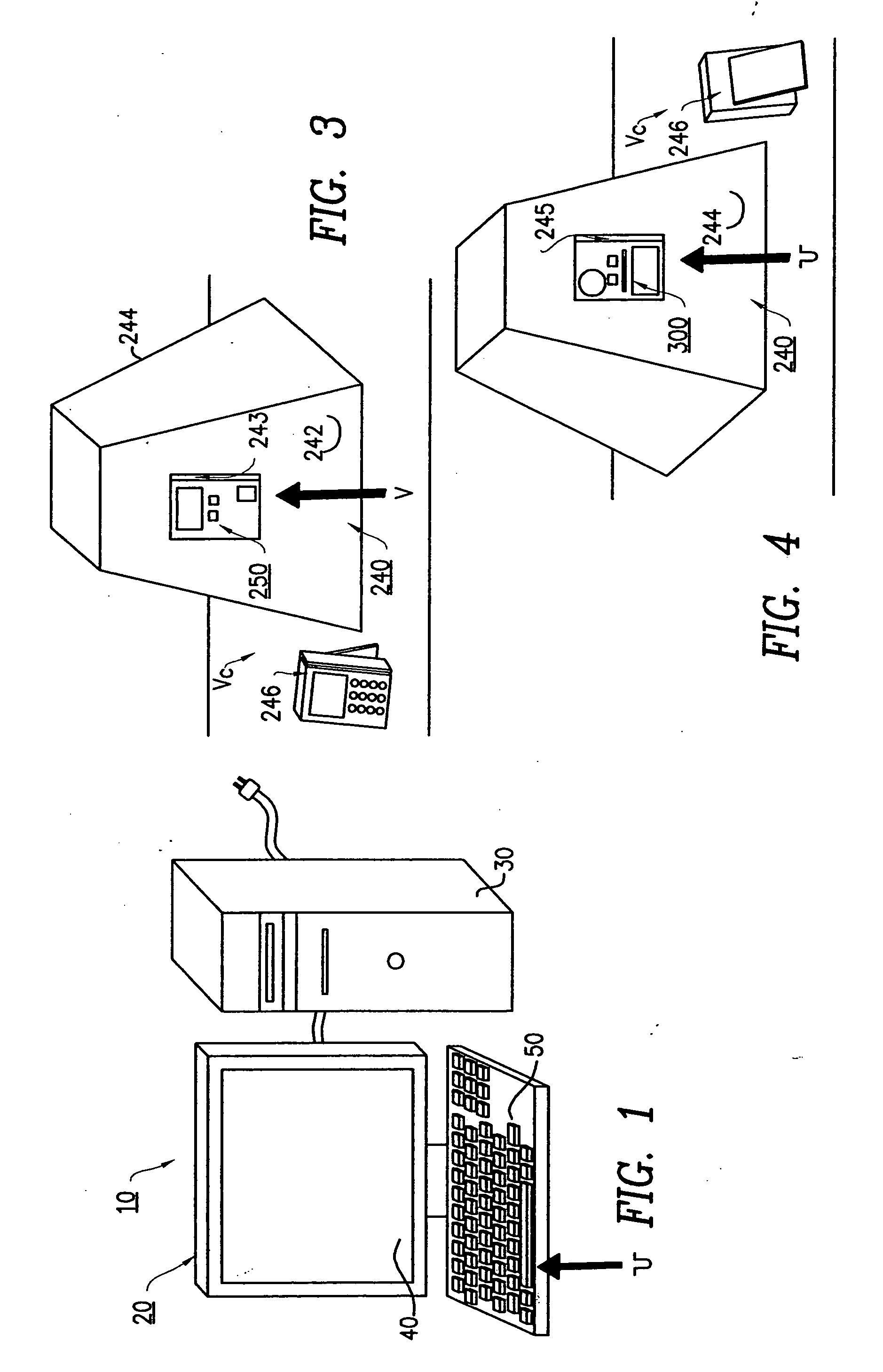

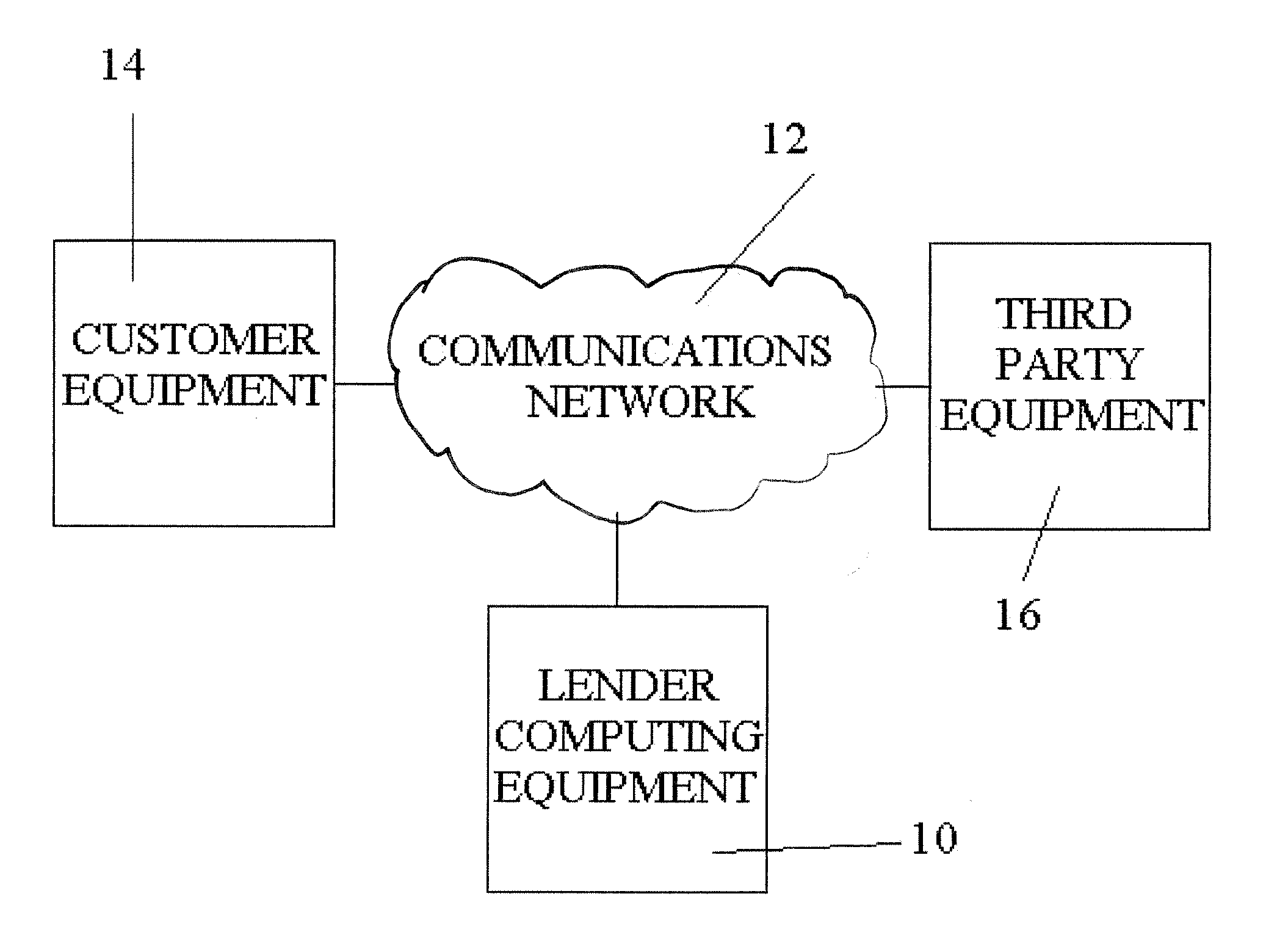

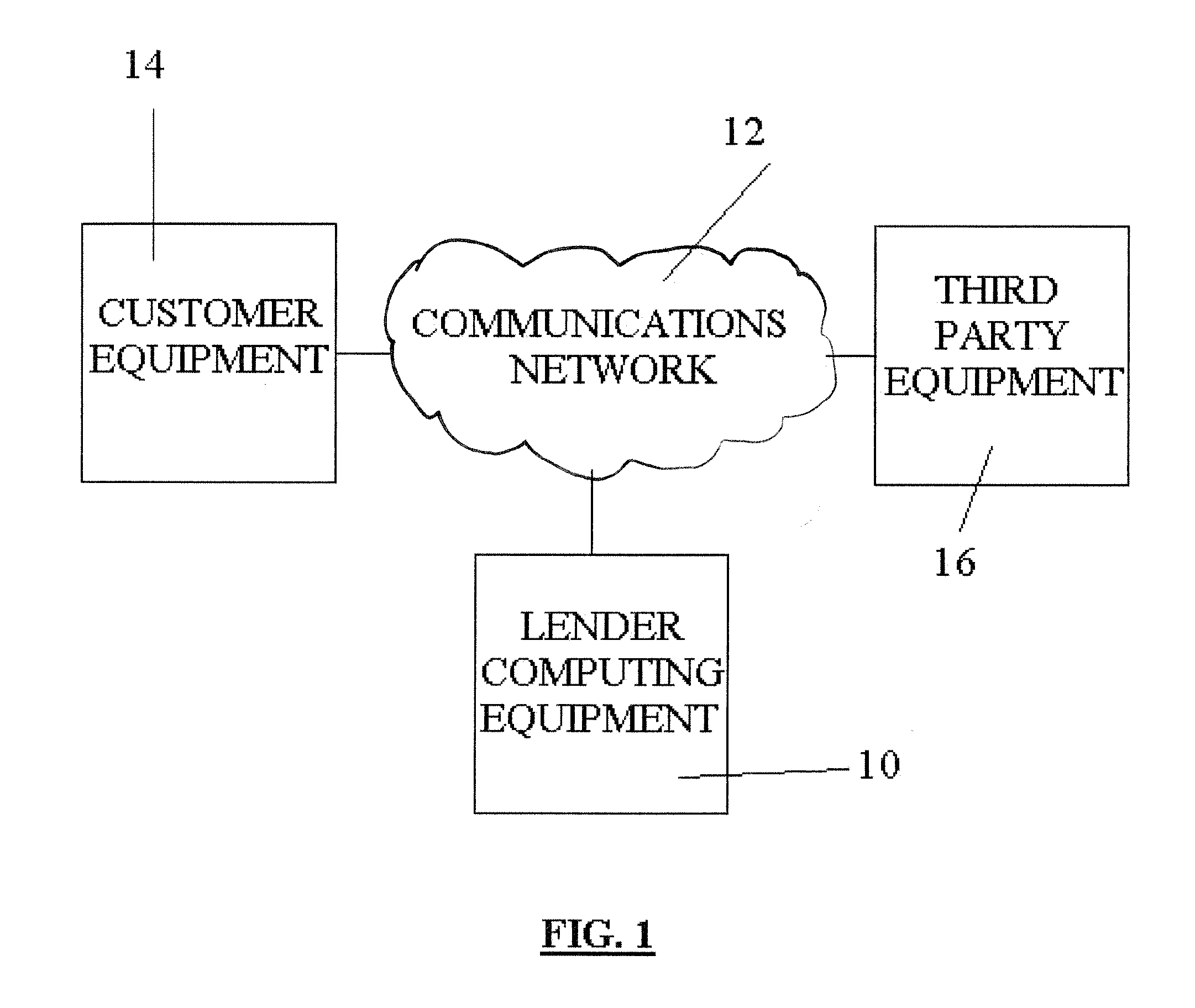

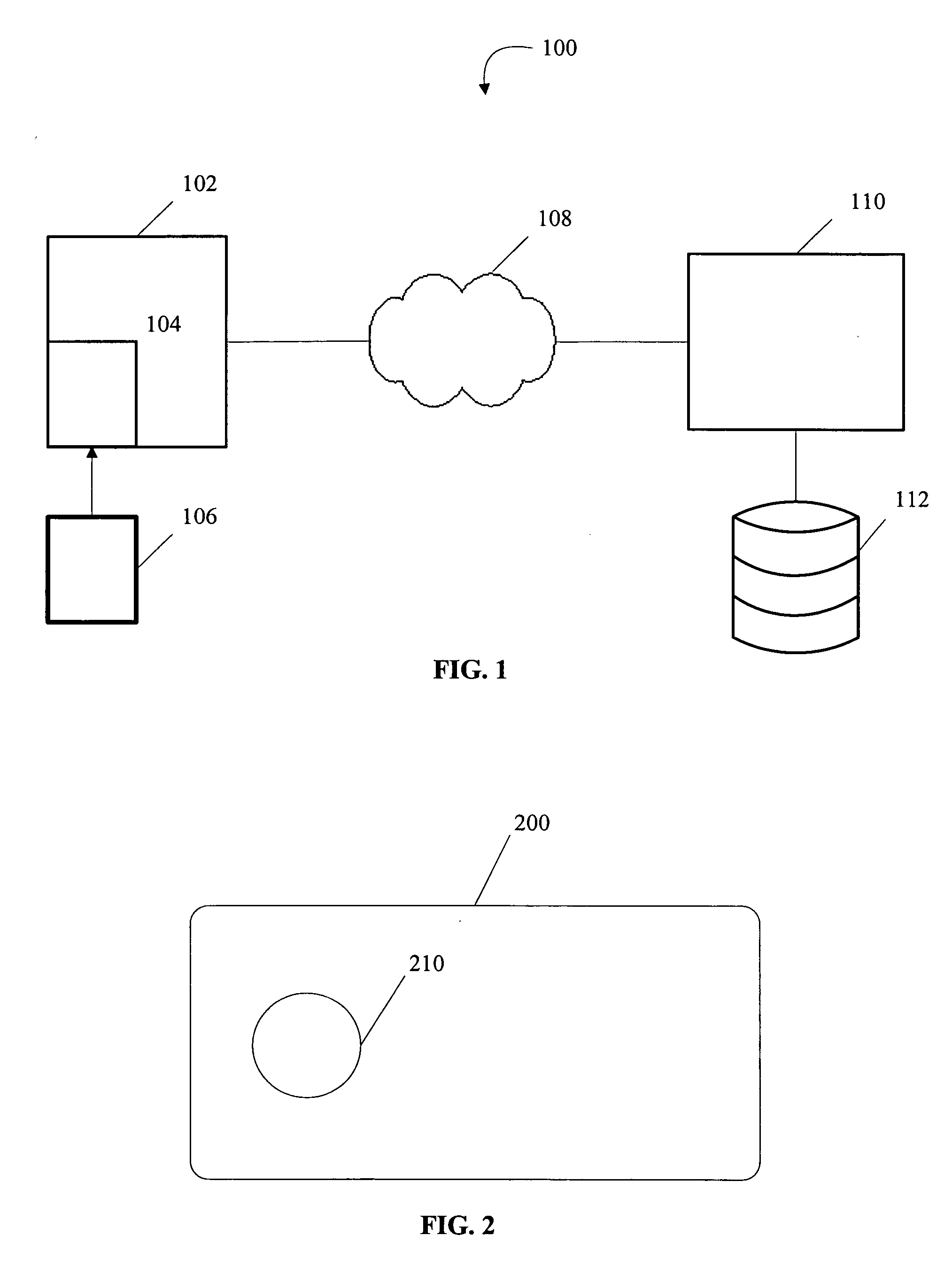

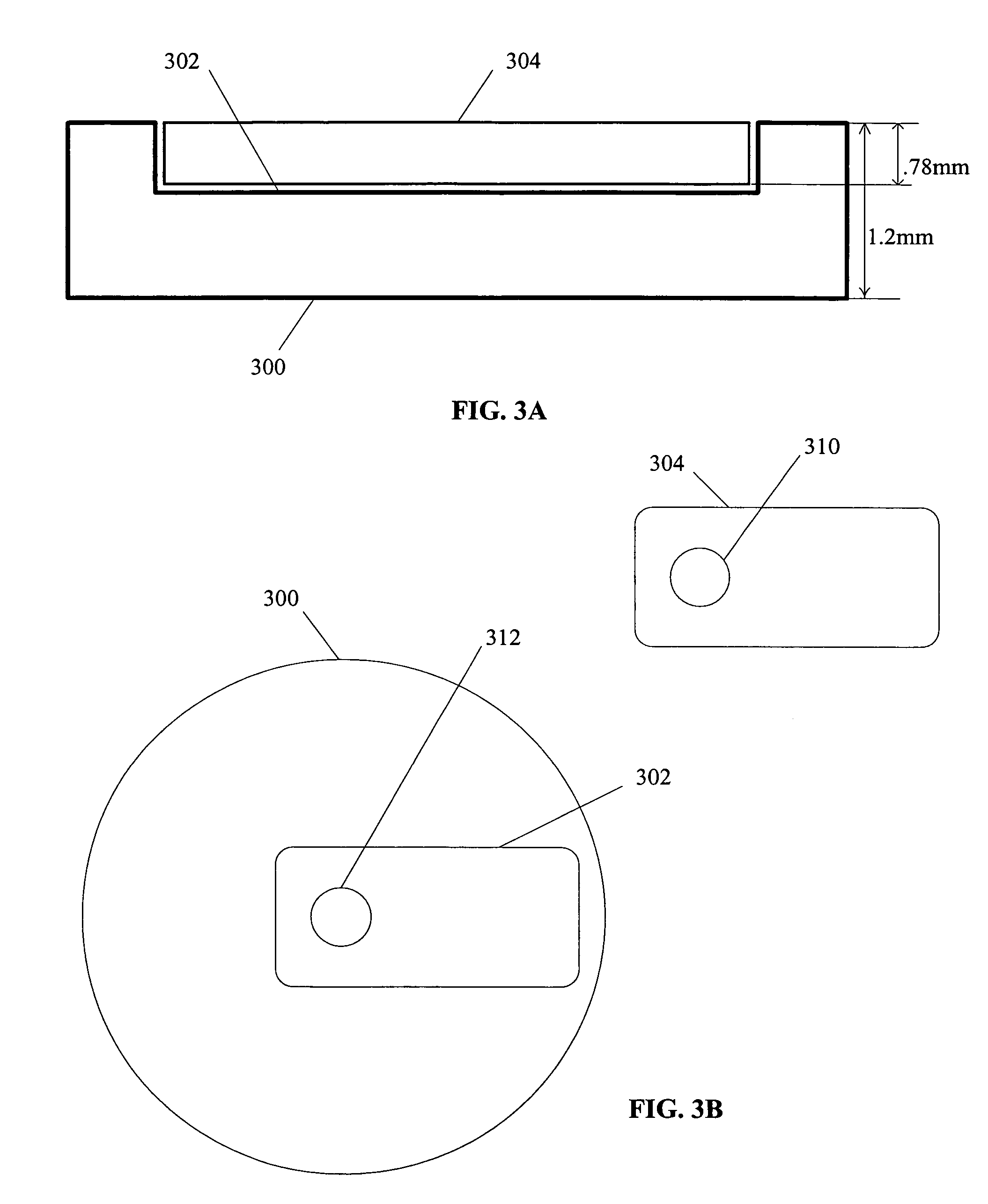

Method, system and computer program for on-demand short term loan processing

A method, system, and computer program for on-demand short term loan processing is disclosed which utilizes computing equipment (10) to expedite loan approval and the transfer of funds. The method preferably includes the steps of: (a) establishing a loan account for a customer (100); (b) providing the customer access to the loan account through an ATM card (102); (c) receiving a loan request from the customer through a communications network (104); (d) approving the loan request immediately by utilizing computing equipment (106); (e) depositing a loan amount immediately into the loan account utilizing the computing equipment such that the loan amount is immediately accessible by the customer through the ATM card (108); and (f) automatically withdrawing the loan amount and a loan fee from the loan account by utilizing the computing equipment when additional funds are deposited into the loan account (110).

Owner:TUCKER SCOTT A

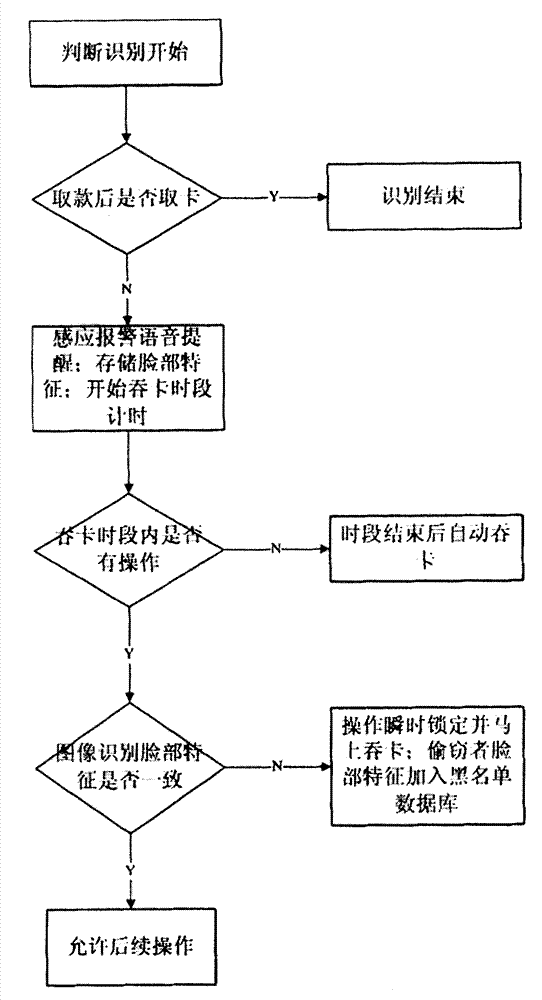

ATM (automatic teller machine) card fetching reminding and thievery prevention system

InactiveCN104751567AProtect funds securityReduce the chance of forgetting to pick up the cardCoin/paper handlersElectric/electromagnetic audible signallingComputer hardwareATM card

The invention provides an ATM (automatic teller machine) card fetching reminding and thievery prevention system. The ATM card fetching reminding and thievery prevention system can trigger a voice alarm through a sensor when a card possessor forgets to fetch a card, and thereby greatly reduces forgetting rate of card fetching, and simultaneously, if the card possessor forgets to fetch the card and leaves, a human face recognition process is started in a card retaining period, and then if the ATM card fetching reminding and thievery prevention system judges out that the original possessor returns to operate the card, the ATM card fetching reminding and thievery prevention system continues to perform input operation, or if not, the ATM card fetching reminding and thievery prevention system regards a transaction input by the user as illegal operation, and immediately locks the transaction and retains the card, and therefore fund security of the card possessor is effectively protected.

Owner:陈鹄

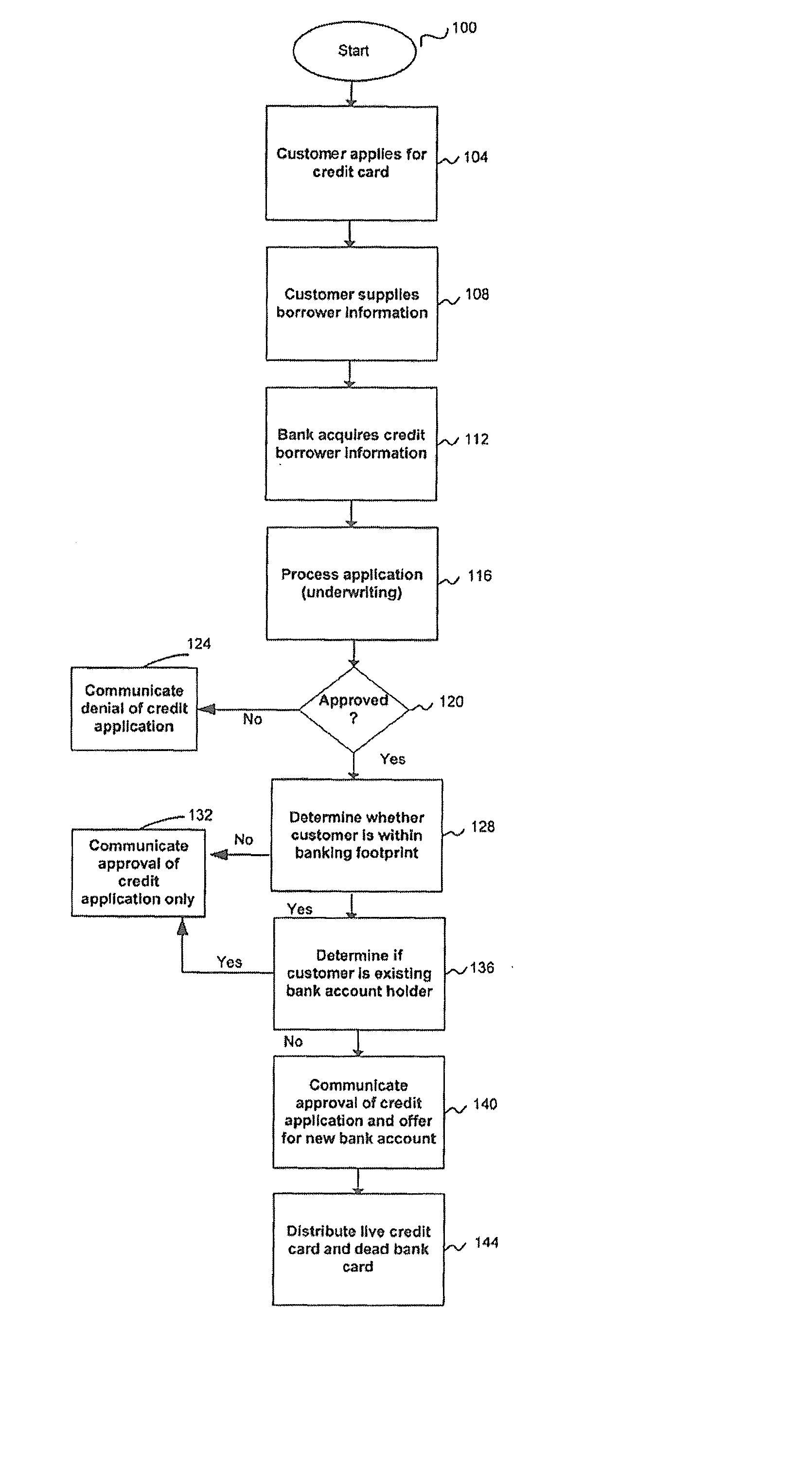

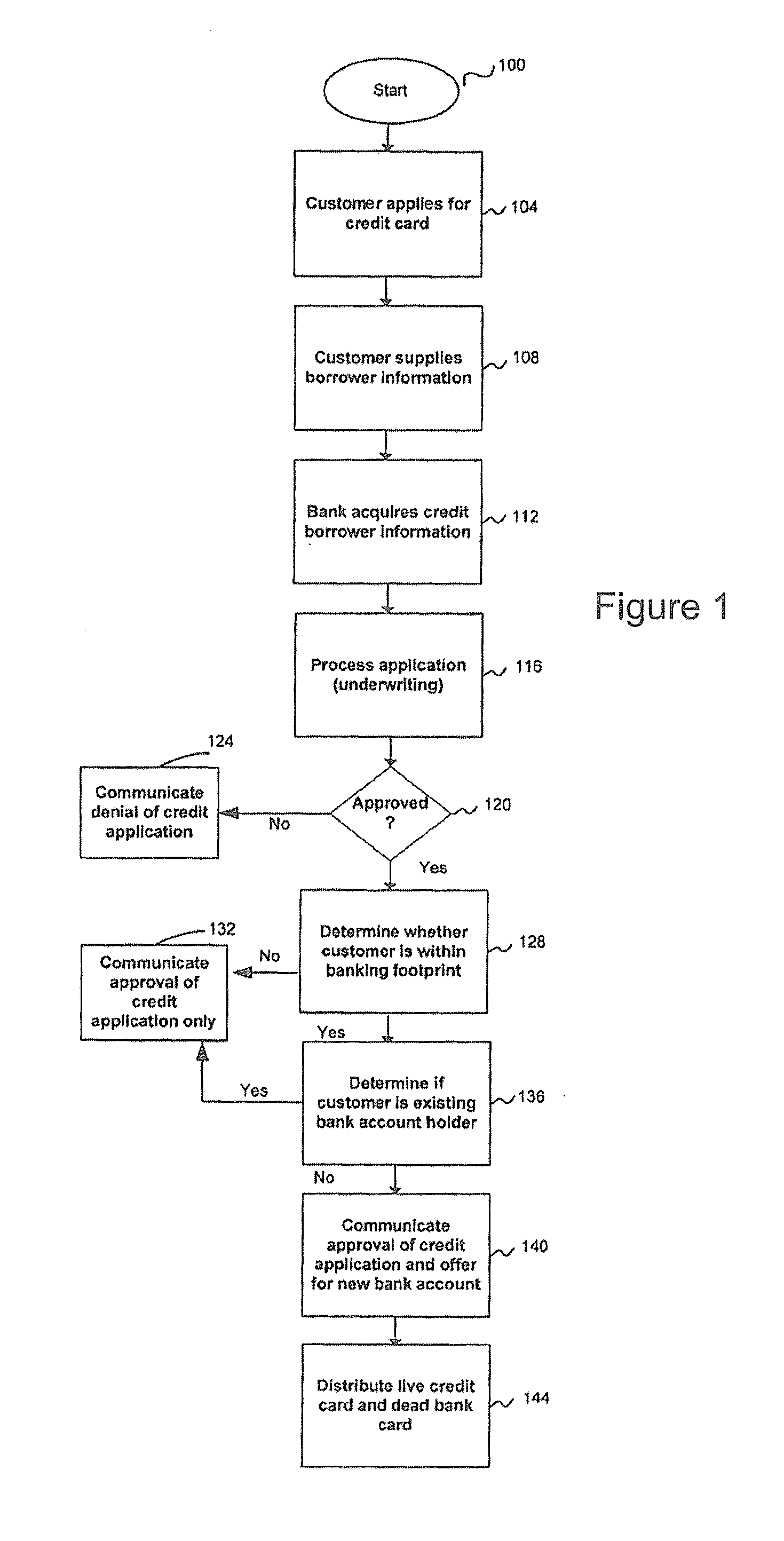

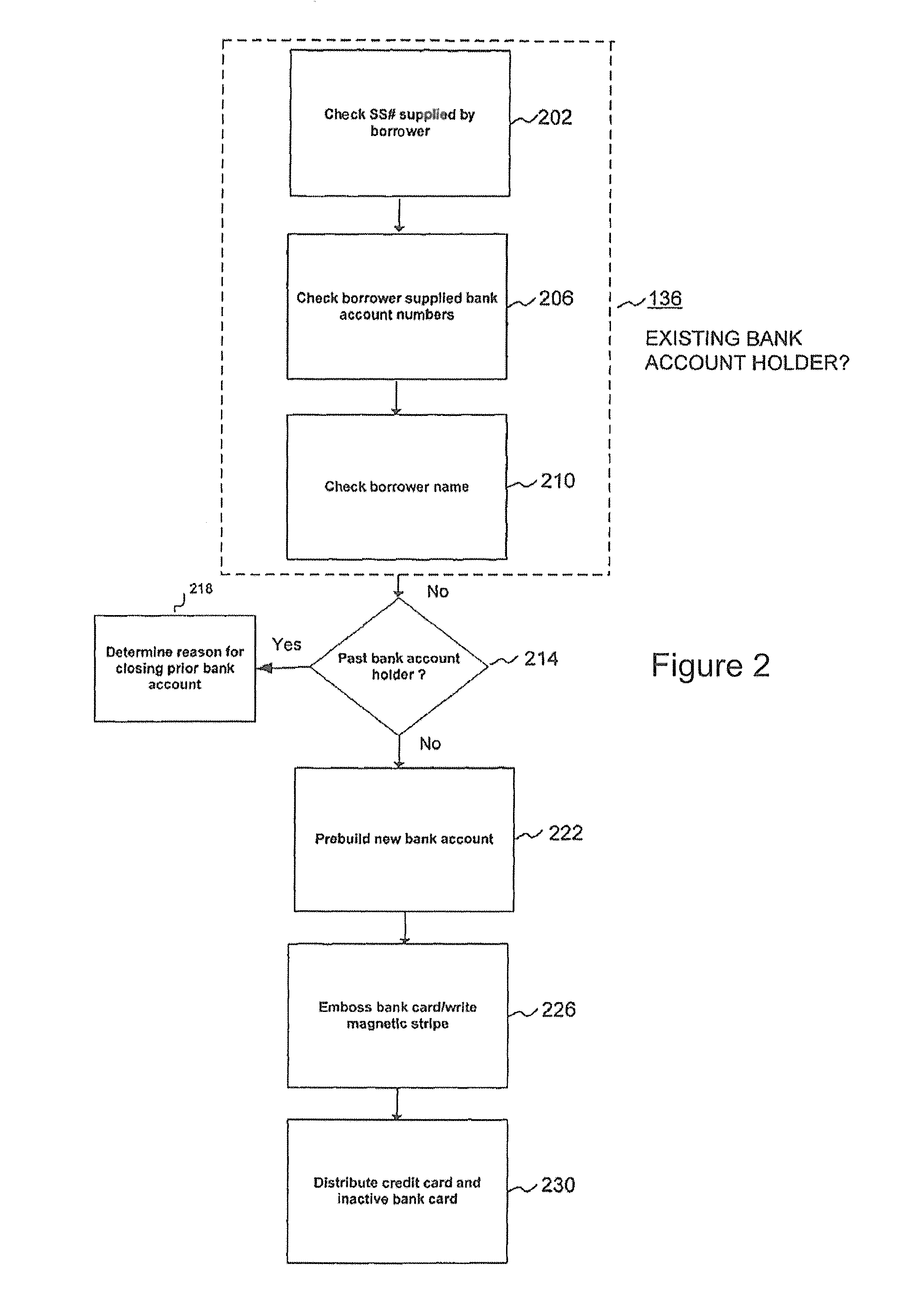

Method and System for Distribution of Unactivated Bank Account Cards

ActiveUS20070299756A1Immediate activationFinancePayment architectureComputer hardwareBiological activation

The invention comprises a method for distributing dead bank cards to customers who have not solicited a bank card or submitted an application. The dead bank card is a bank card (e.g., ATM card, debit card, check card, and the like) which contains all necessary information to be used, including a pre-assigned bank account number, and which only requires activation / approval by the prospective new bank account customer. In one embodiment, the dead bank card is distributed in connection with live credit cards issued to applicants for credit card accounts. Once operative, the bank card and the credit card may be linked together through a rebate / rewards program.

Owner:CHASE MANHATTAN BANK USA NAT ASSOC

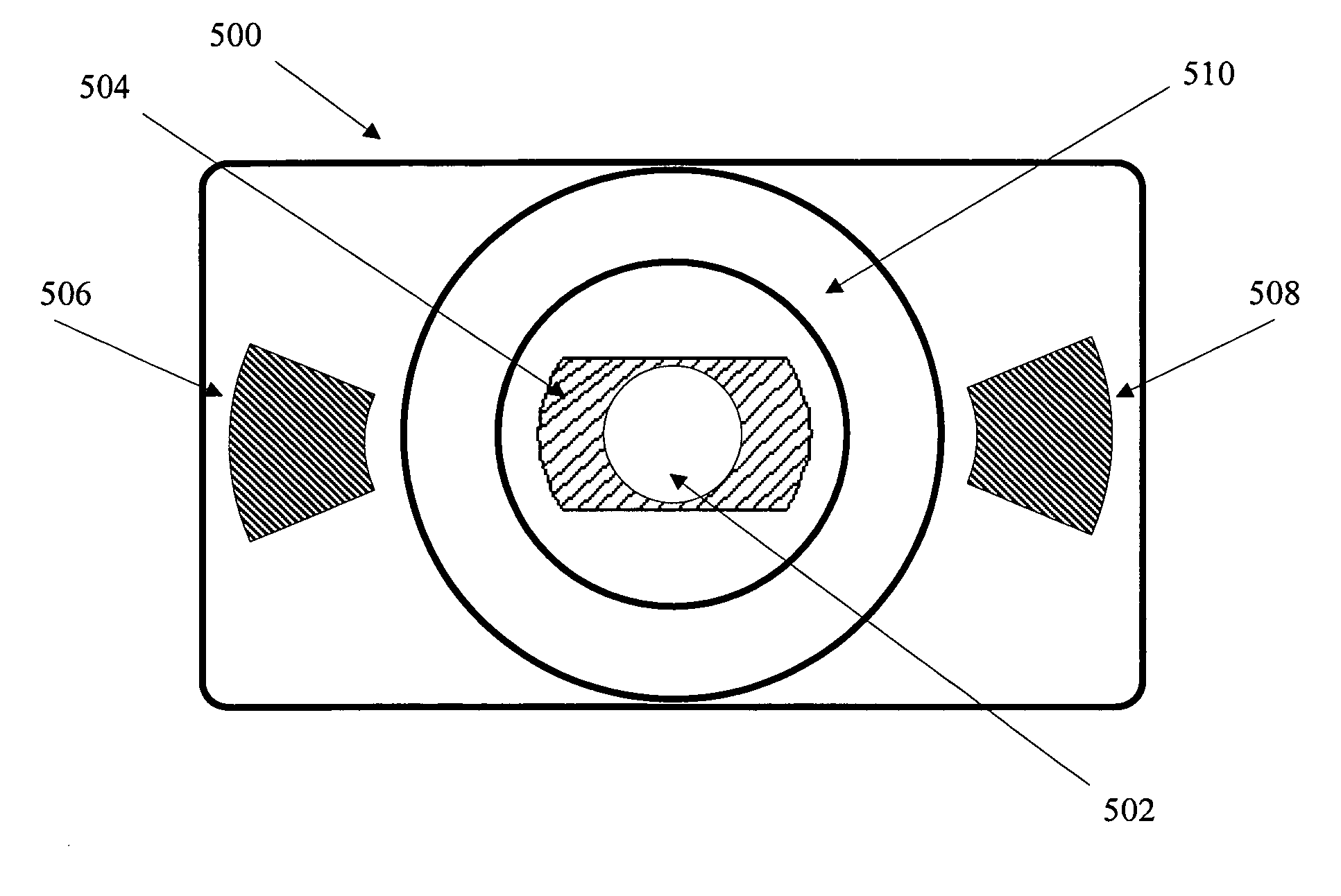

Systems and methods for copy protection during multi-factor authenticating of electronic transactions

InactiveUS20070150416A1Prevent copyingComputer security arrangementsPayment architectureE-commerceOptical storage

A specially configured payment card that functions as both a standard payment, e.g., bank credit, debit, or ATM card for use in point-of-purchase transactions and an optical storage device that can be read by any common CD or DVD drive for use in secure online E-Commerce transactions. In order to prevent copying of the data stored in the optical storage media, a code can be included in the Absolute Time In Pregroove (ATIP) area of the optical media. This code can be used in order to protect against the use of counterfeit cards in online transactions.

Owner:U S ENCODE CORP

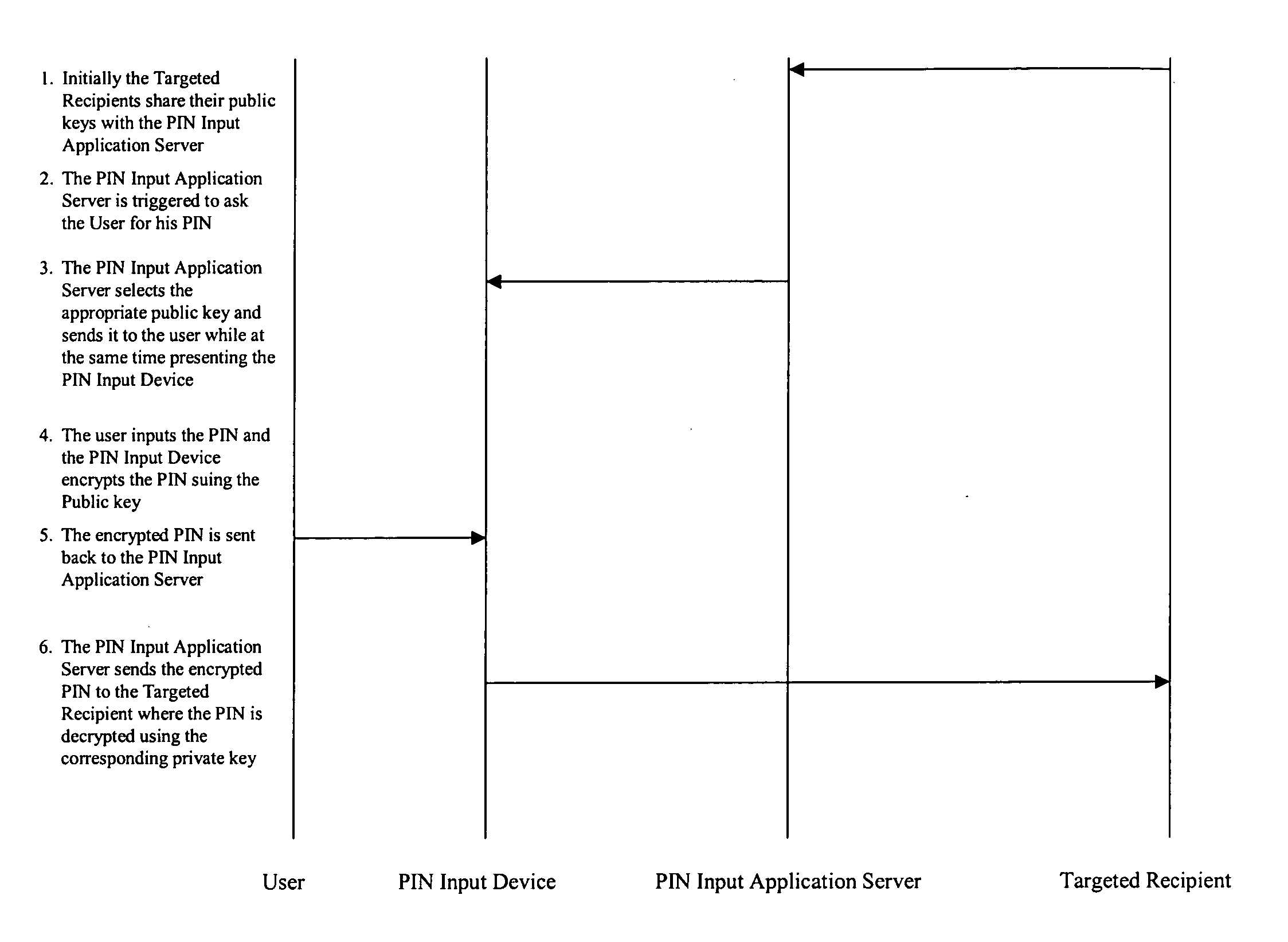

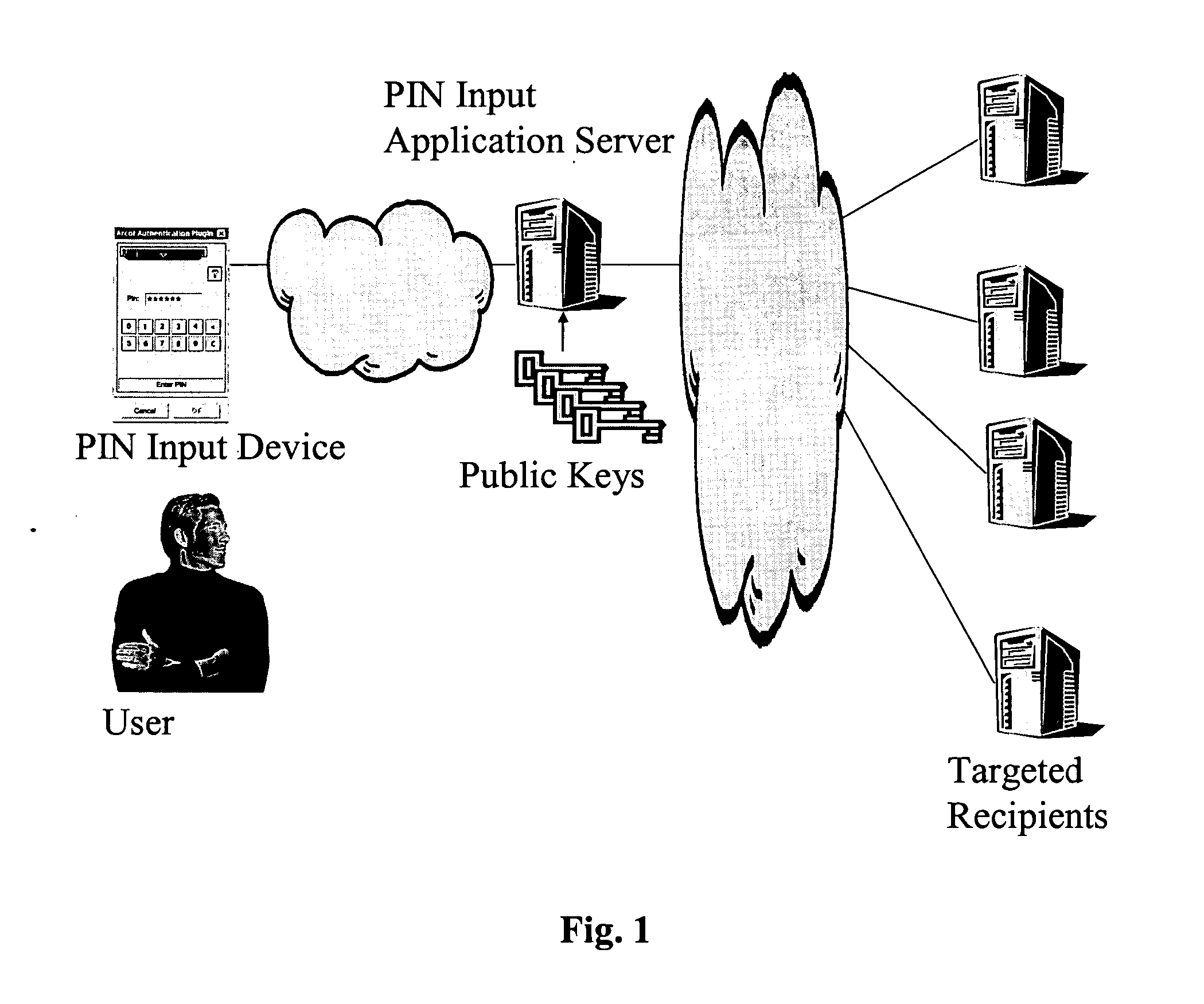

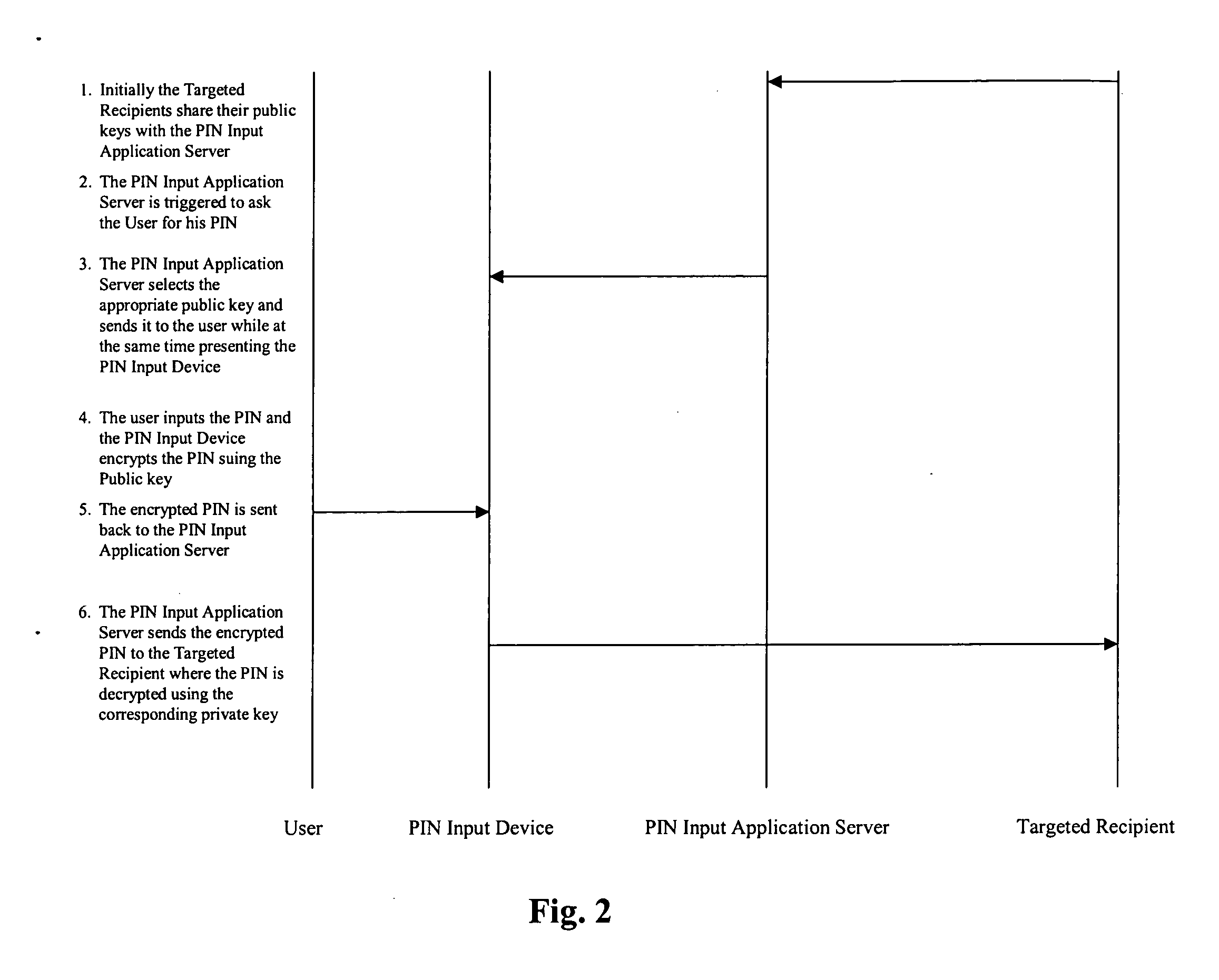

Method and apparatus for securing pass codes during transmission from capture to delivery

InactiveUS20050010751A1Programme controlElectric signal transmission systemsComputer hardwareThird party

A user can securely enter a shared secret such as a pass code code, pass code or combination of symbols, in a generic computing environment, and deliver it securely to the recipient via an arbitrary network. As an example of such environment, pass code codes protecting an ATM card often need to be communicated to a bank's validation system. The pass code can be entered via a Web interface and delivered over the Internet via third-party network operators while never being exposed to intermediaries.

Owner:CA TECH INC

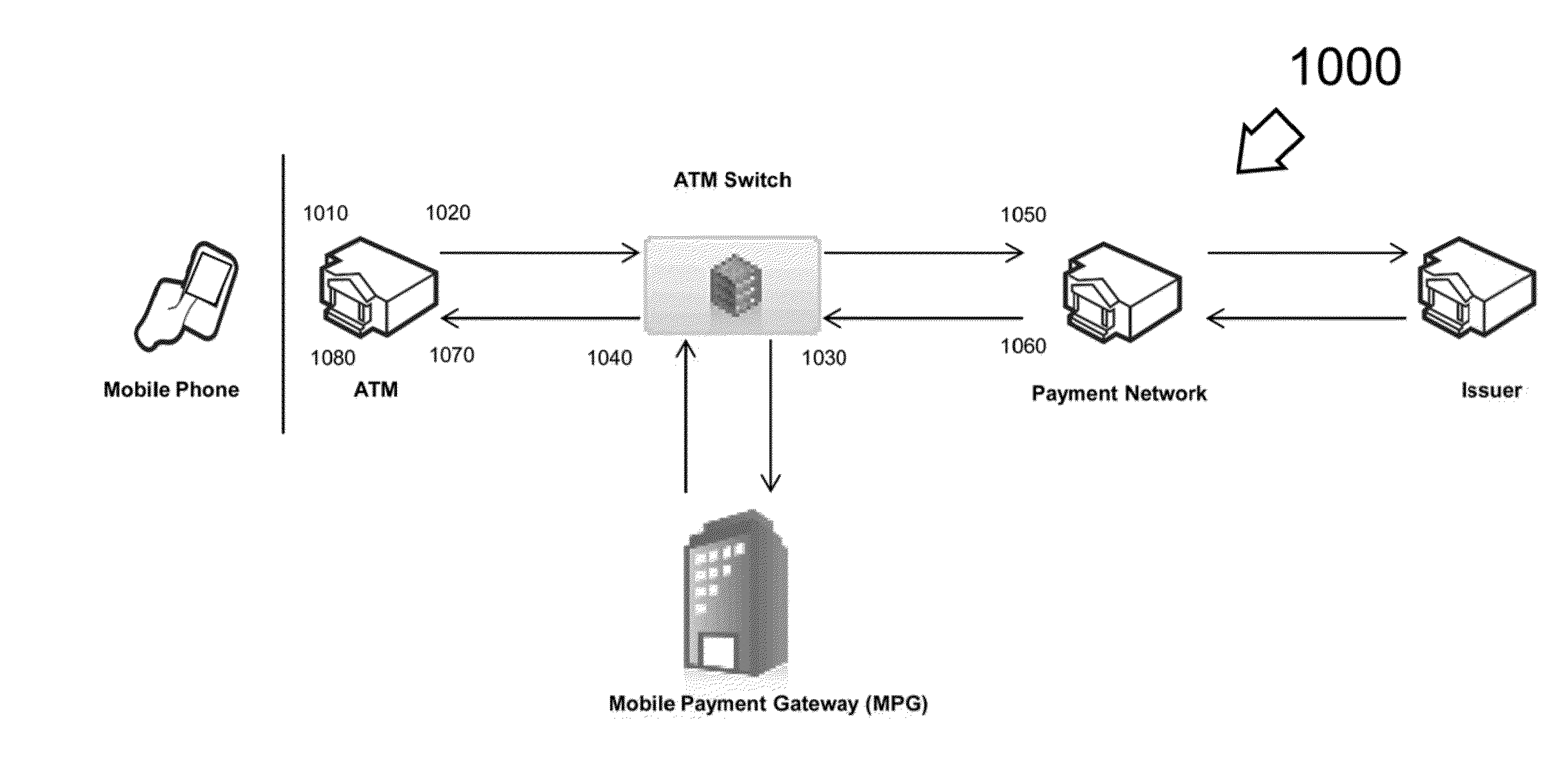

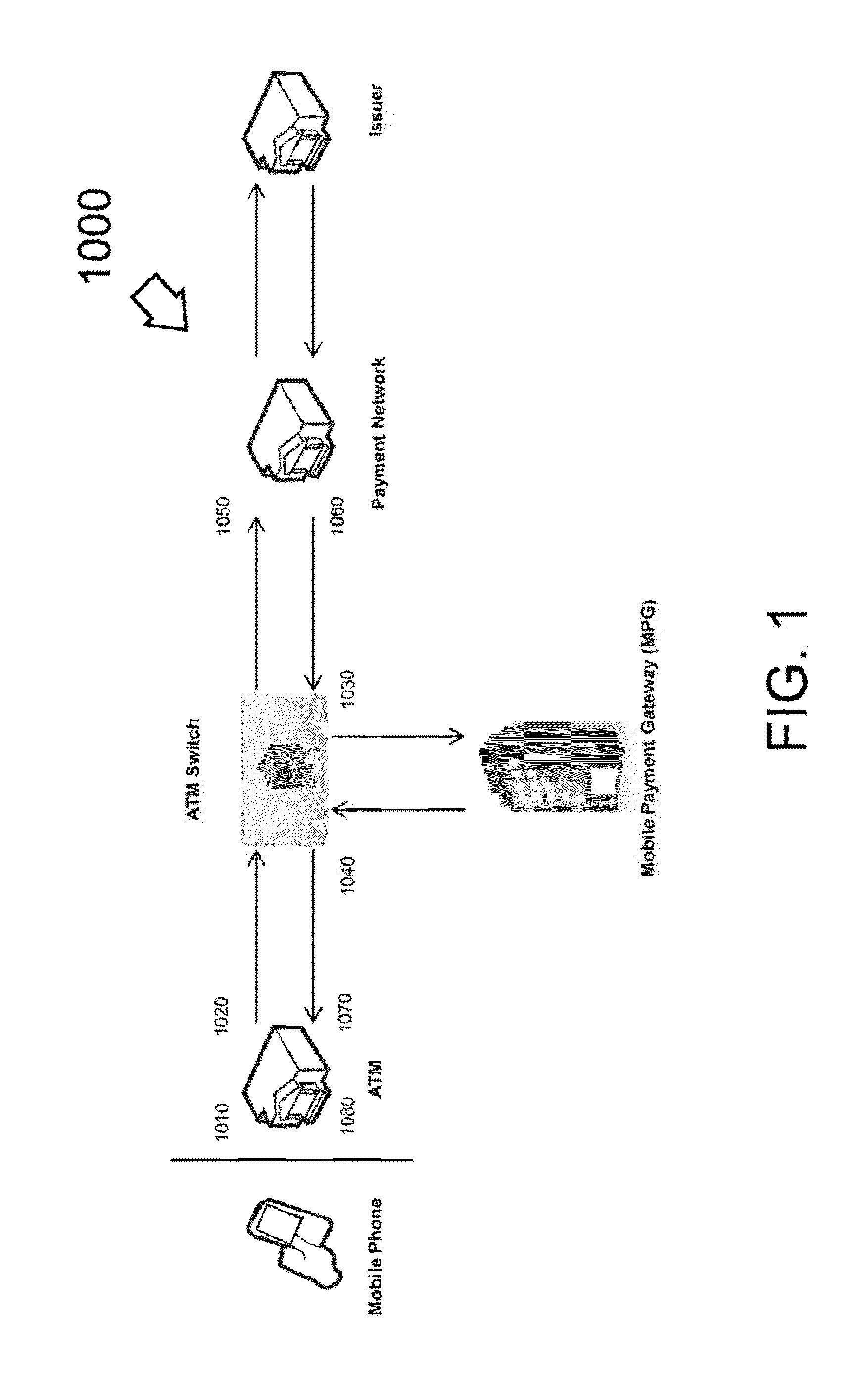

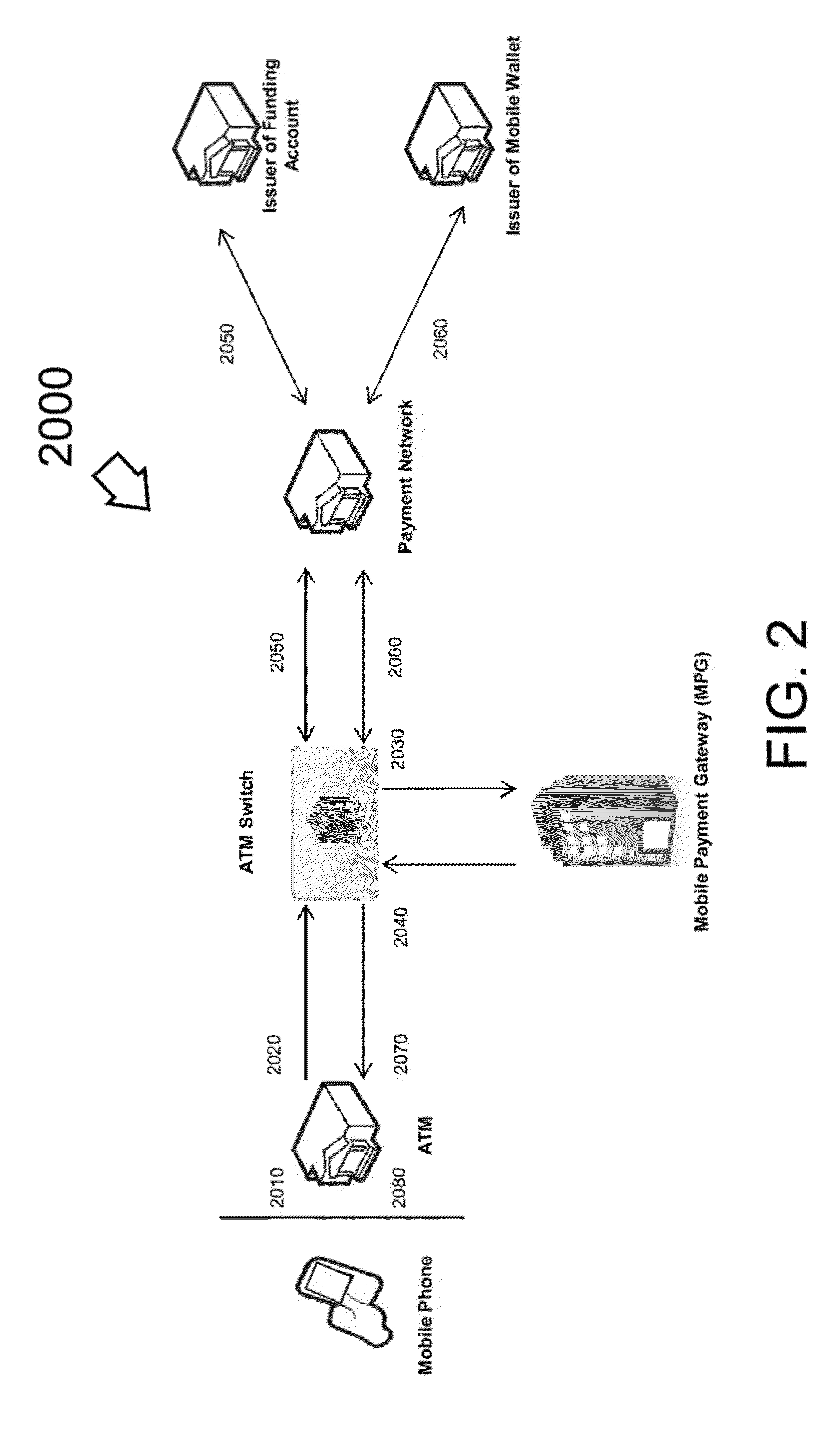

System and Method of Electronic Authentication at a Computer Initiated Via Mobile

InactiveUS20160063481A1Facilitate various transactionCryptography processingSecuring communicationMobile deviceATM card

Owner:MASTERCARD INT INC

Method of and system for making purchaser over a computer network

A method of and system for making purchases over a computer network using an ATM card or the like is provided. In accordance with the invention, a consumer transmits his ATM card number over the network to an on-line merchant. The on-line merchant then forwards the ATM card number to a third party contractor, such as a bank, that will oversee and authorize the transaction. Simultaneously or thereafter, the consumer transmits his PIN over the network to the third party contractor, who verifies that the ATM card number and PIN are valid.

Owner:MASTERCARD INT INC

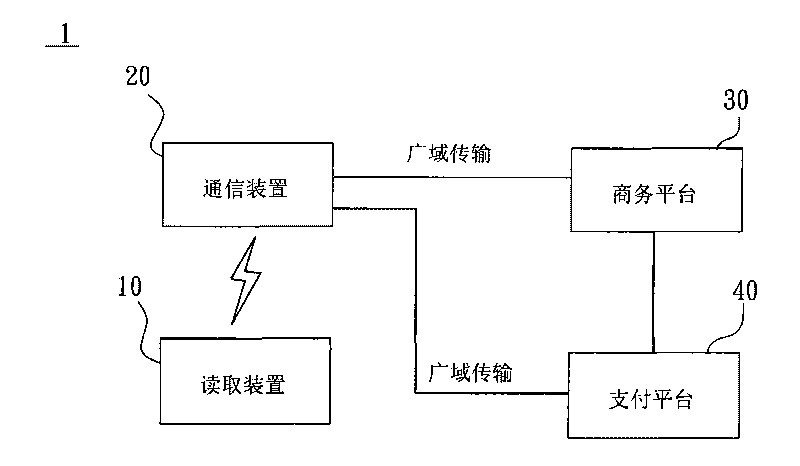

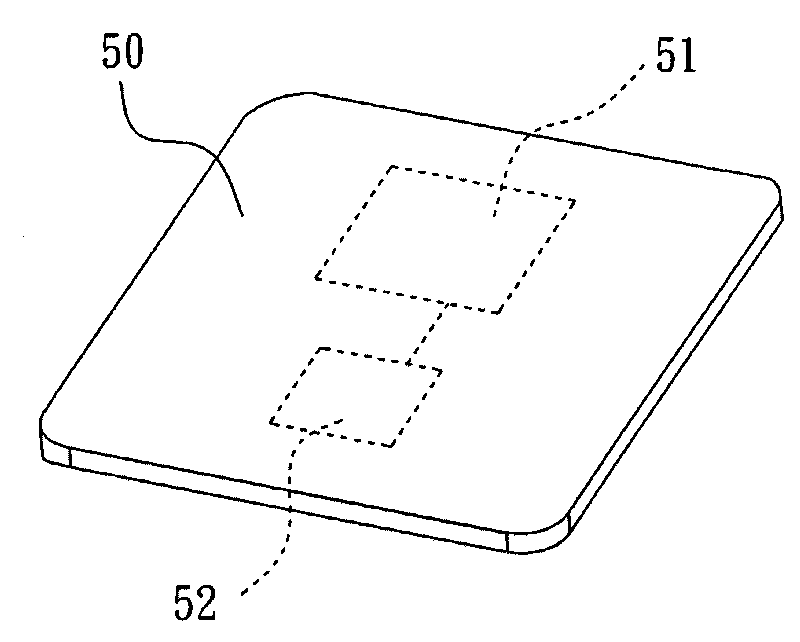

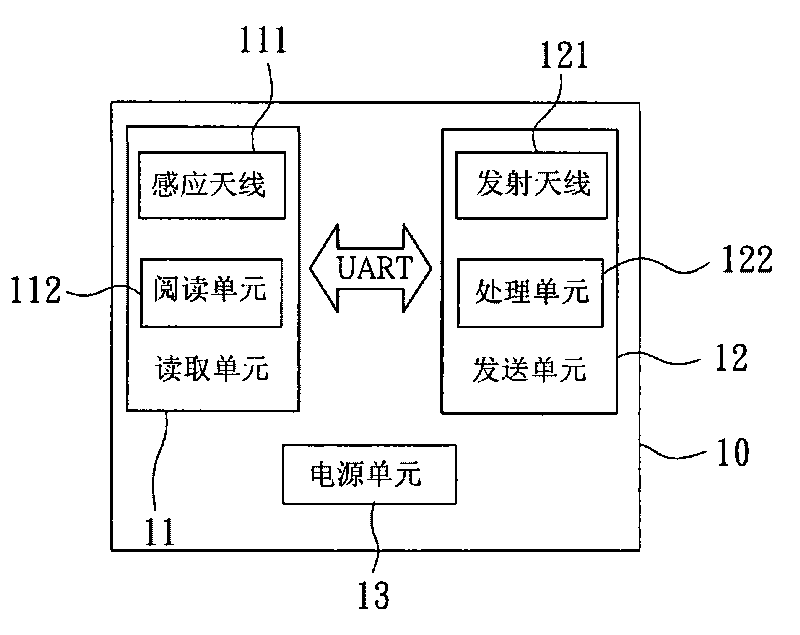

Wireless trading system and trading method thereof

InactiveCN101751628AImprove securityImprove conveniencePayment architectureCoded identity card or credit card actuationComputer scienceCommunication device

The invention discloses a wireless trading system and a trading method thereof. The wireless trading system comprises a reading device, a communication device, a business platform and a payment platform. The reading device comprises a reading unit which is used for reading the account information of an ATM card and a transmitting unit which is used for transmitting the account information to the communication device. The communication device performs the shopping and the payment with the business platform and the payment platform through the account information which is transmitted by the reading device. When the wireless trading system is used for trading, the reading device reads the account information of the ATM card in a non-contact reading way and transmits the account information to the communication device, and the operations of the transaction and the payment are carried out through the communication device, so the ATM card can be prevented from handing over to other people, and the trading safety and convenience can be improved.

Owner:FUGANG ELECTRONICS KUNSHAN +1

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com