Patents

Literature

55 results about "Direct deposit" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

In banking, a direct deposit (or direct credit) is a deposit of money by a payer directly into a payee's bank account. Direct deposits are most commonly made by businesses in the payment of salaries and wages and for the payment of suppliers' accounts, but the facility can be used for payments for any purpose, such as payment of bills, taxes, and other government charges. Direct deposits are most commonly made by means of electronic funds transfers effected using online, mobile, and telephone banking systems but can also be affected by the physical deposit of money into the payee's bank account.

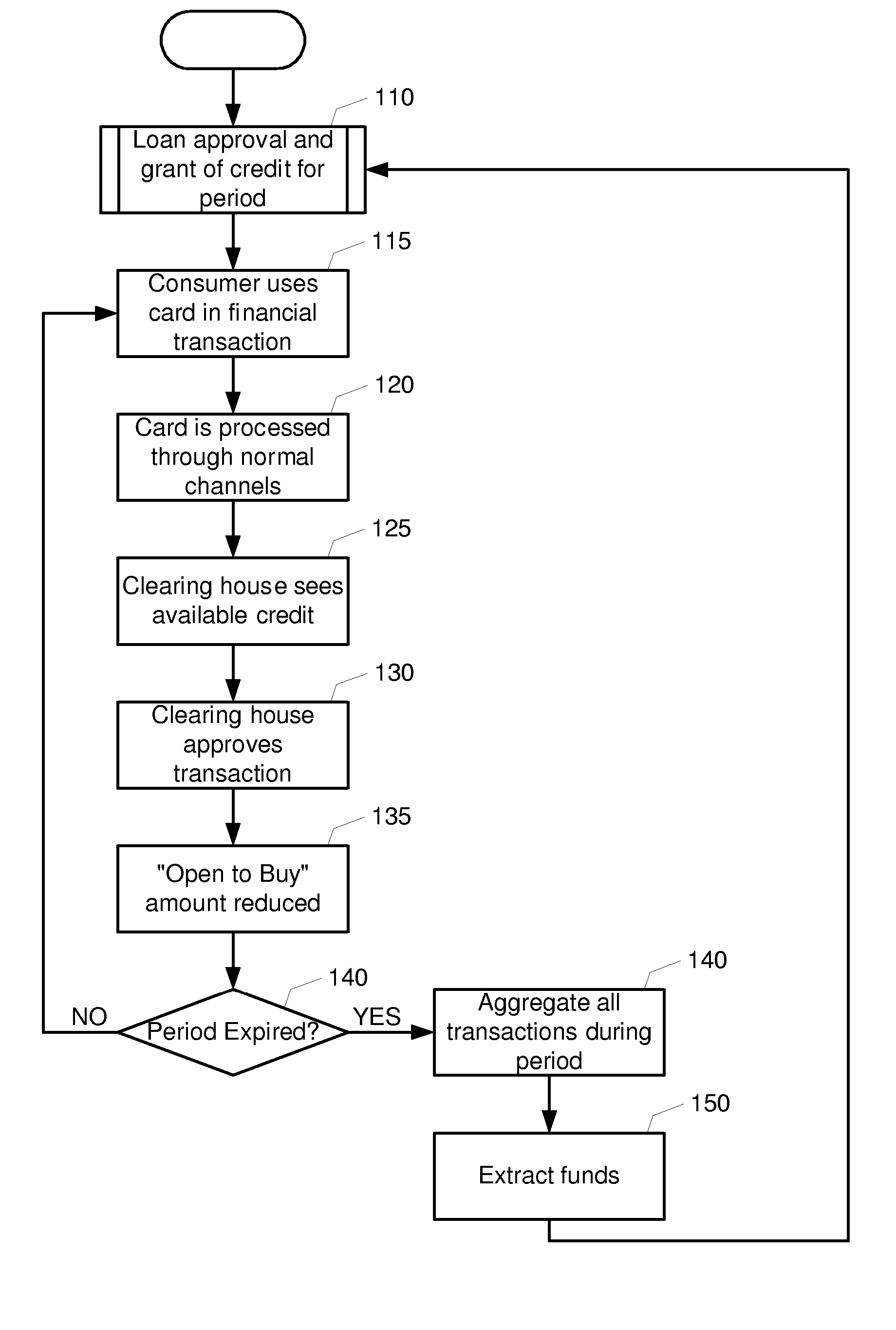

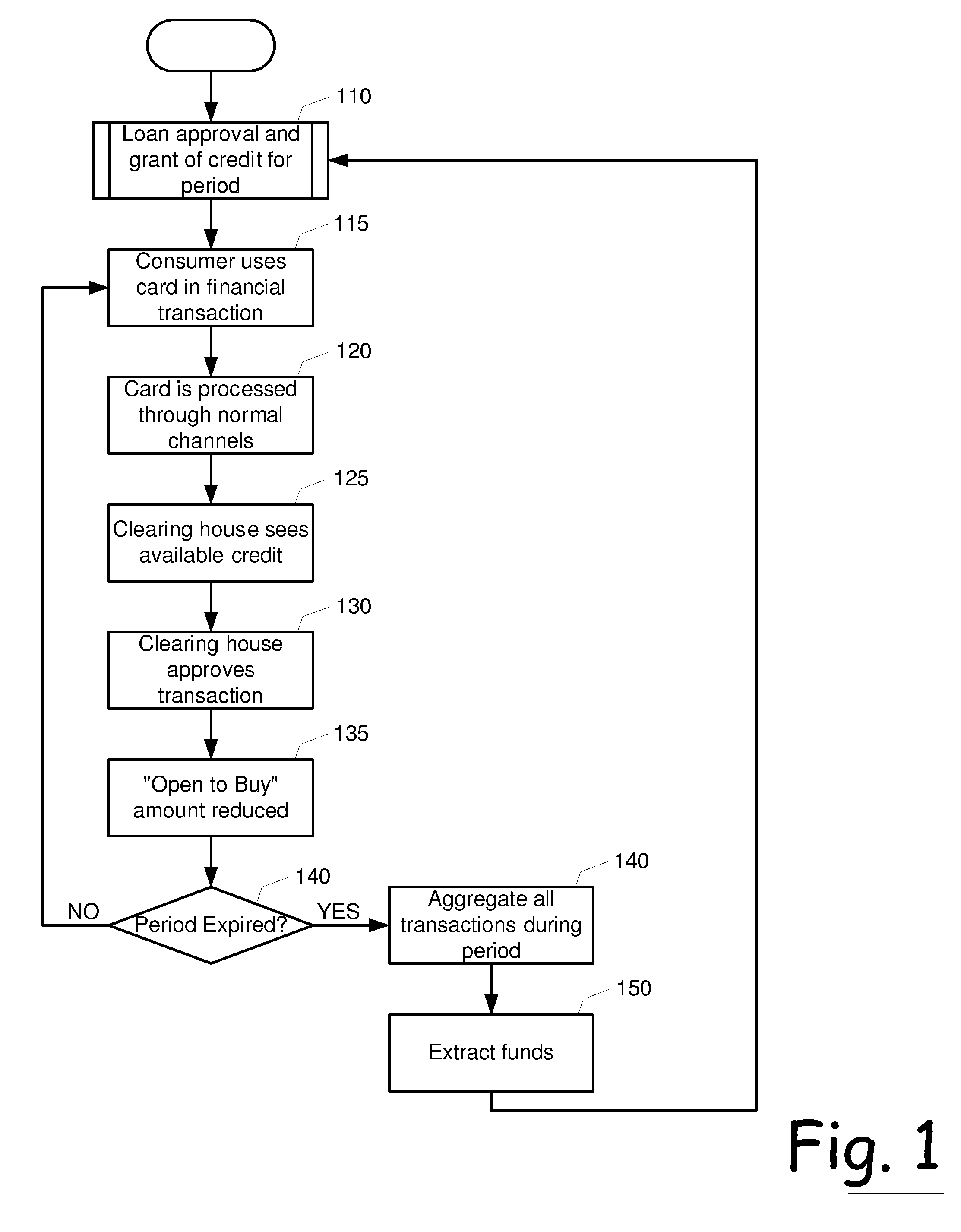

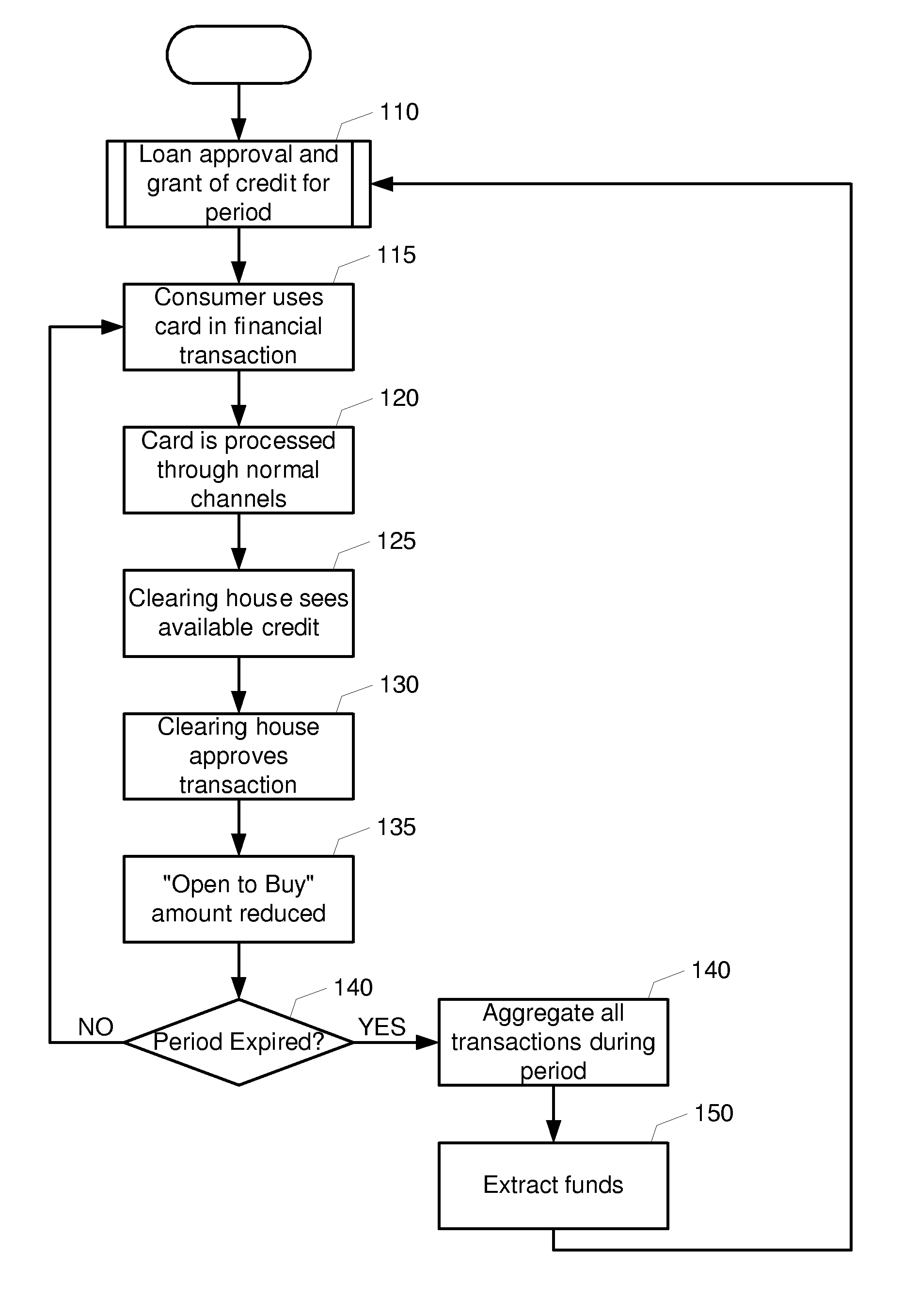

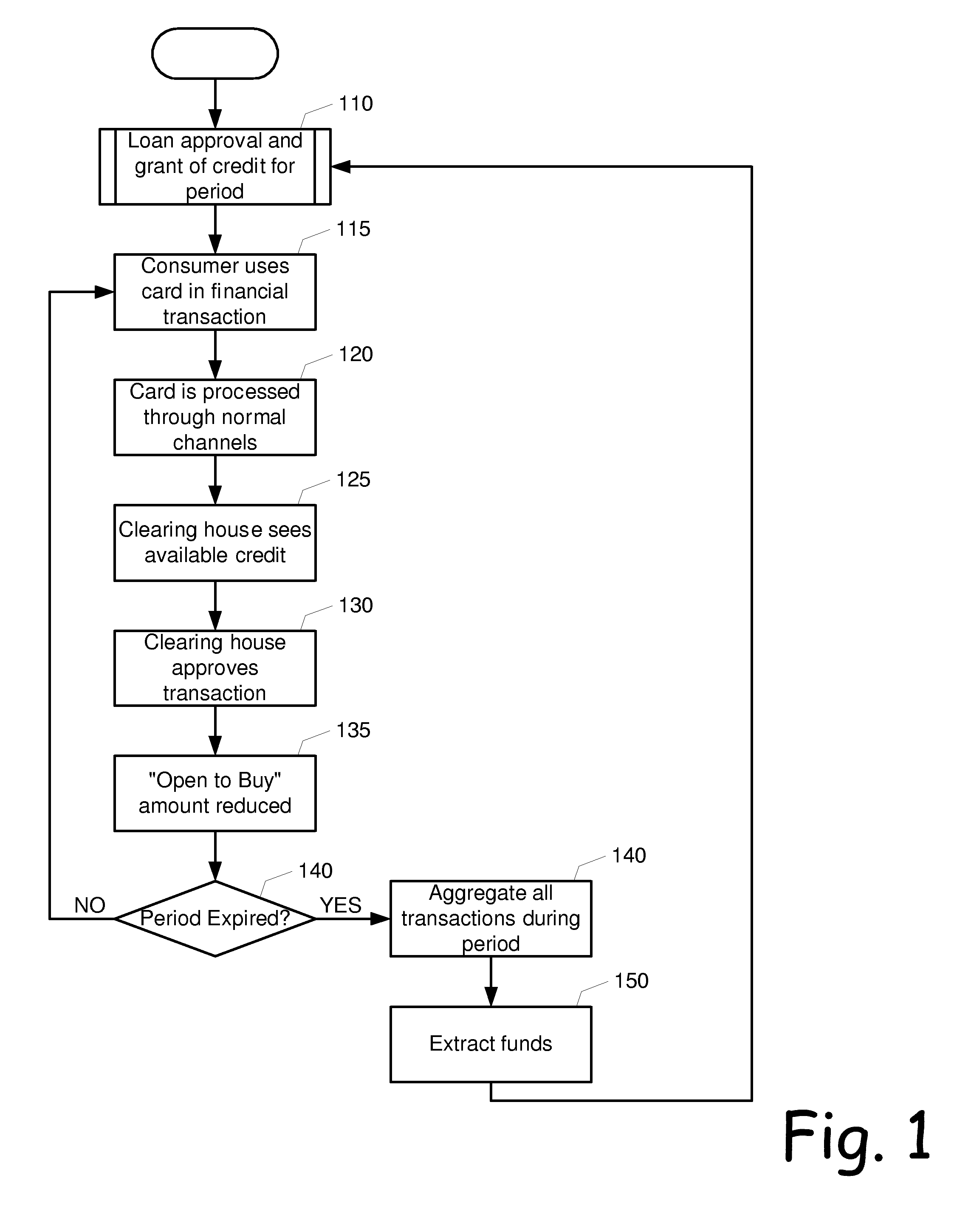

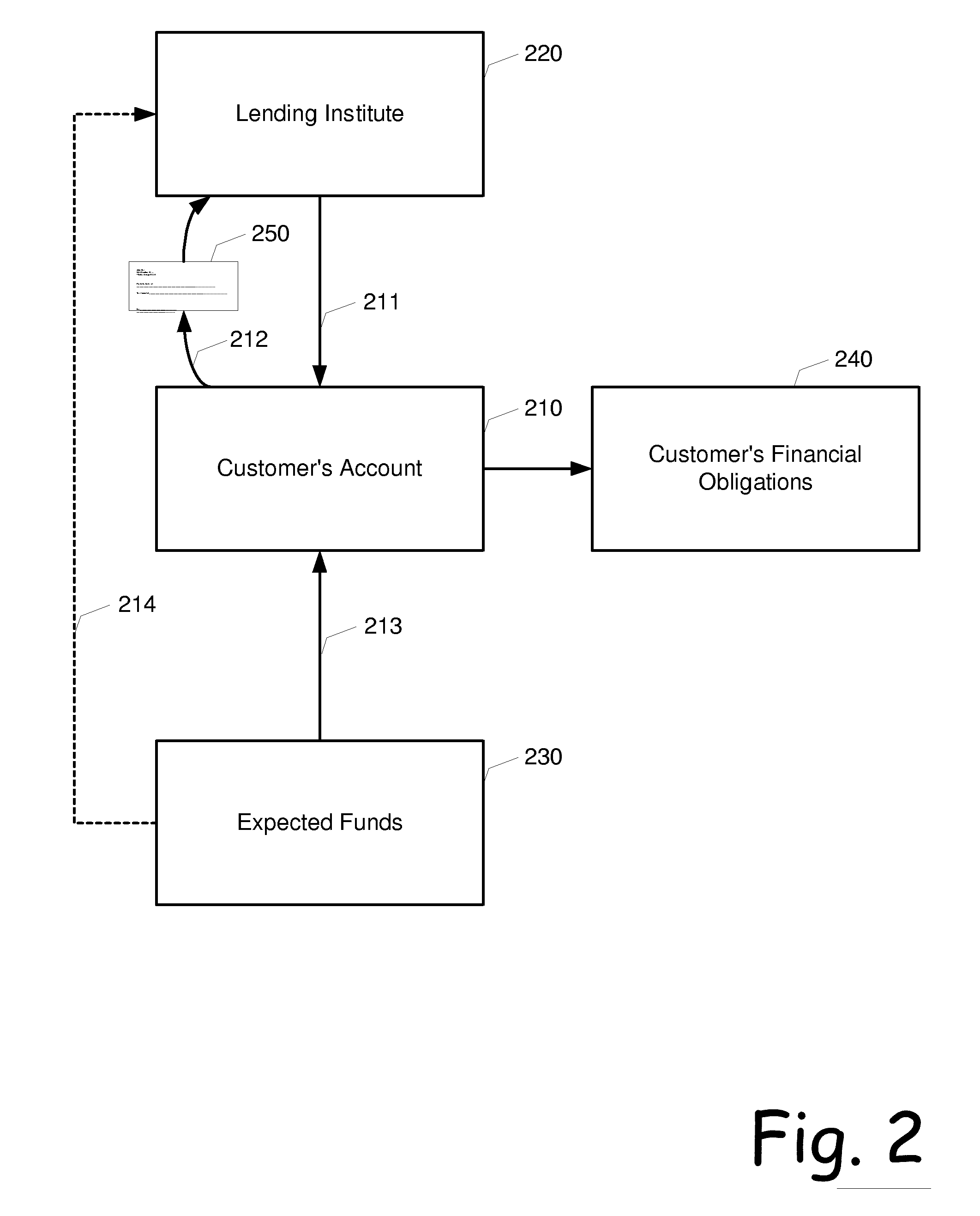

Credit underwriting based electronic fund transfer

A credit underwriting technique that allows a consumer to gain early access to funds for paying bills or conducting financial transactions contingent upon the consumer having a high-degree of reliability on the reception of future funds, and / or the granting of access to at least a portion of the funds represented by the future funds when received. The access can be in the form of an electronic transfer from an account in which the funds are deposited, or a direct deposit of the funds into either a lender accessible account or into the lenders account directly. The access can be applied for aggregated financial transactions or can be periodically applied for recurring transactions.

Owner:COMPUCREDIT INTPROP HLDG CORP II

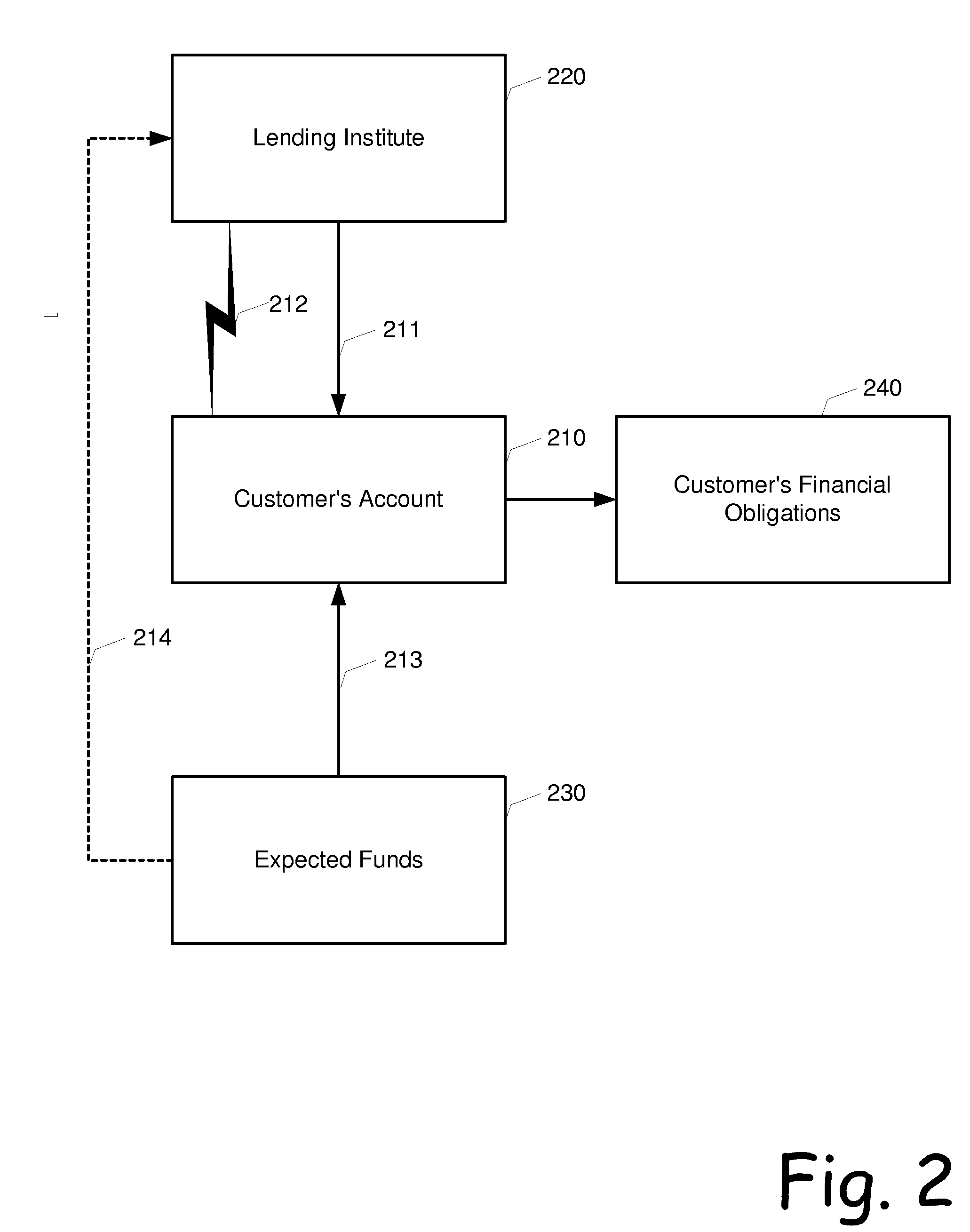

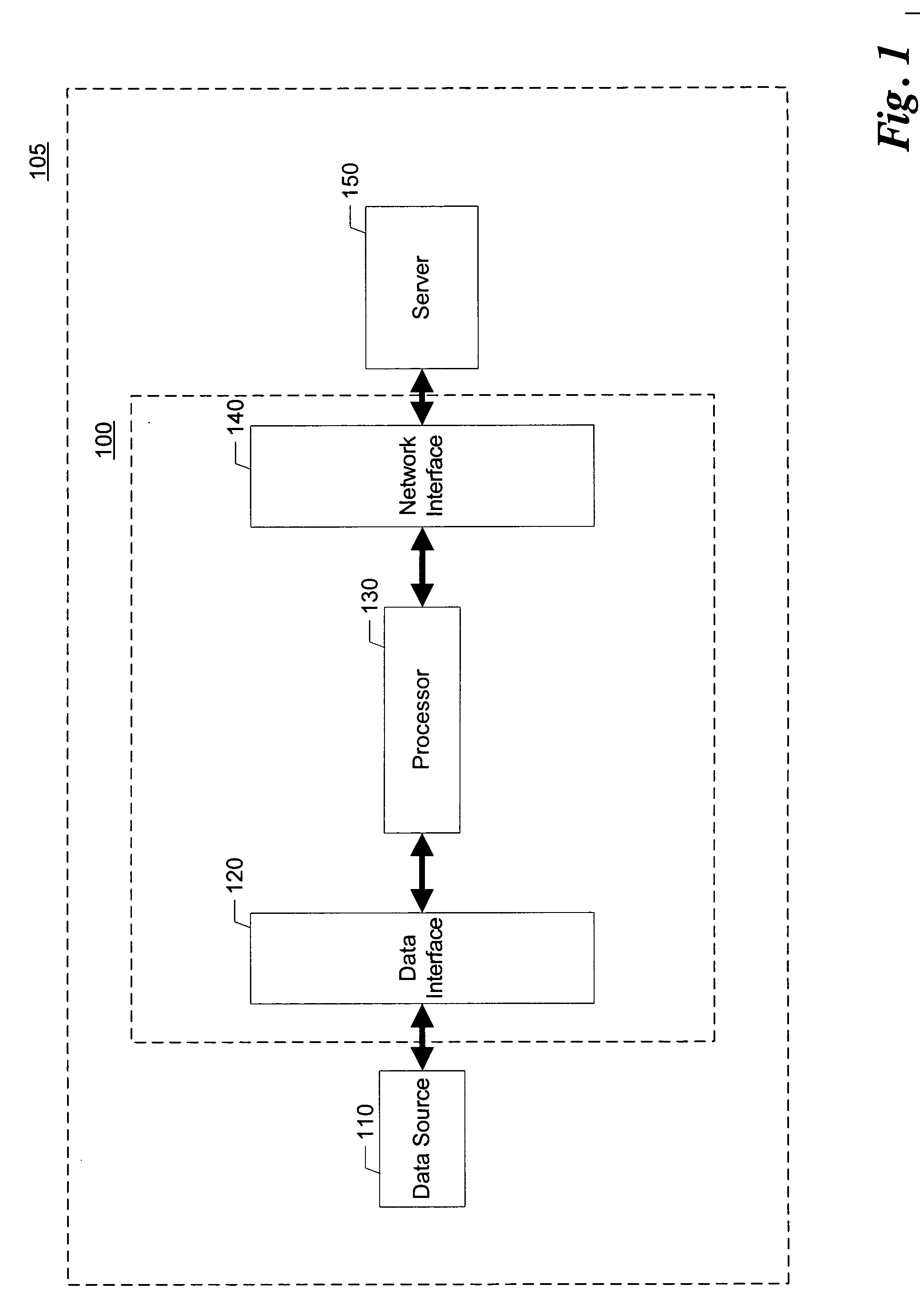

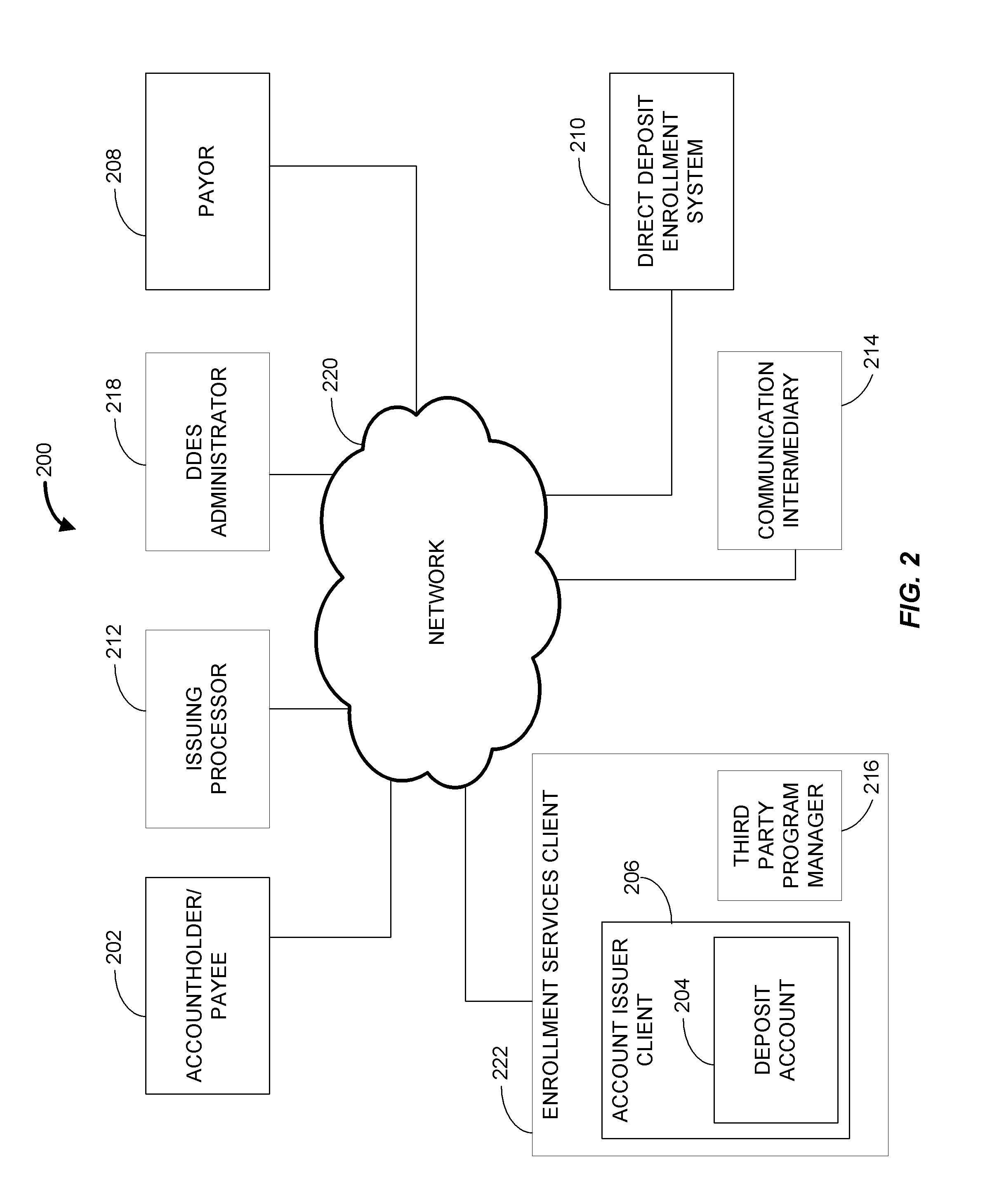

Methods and systems for transferring funds to direct-deposit accounts

Methods and systems are provided for depositing funds in a deposit account. A request to credit a specified amount to the deposit account is received at a node of a financial-services network that has multiple interconnected nodes. The request includes an indirect identification of the deposit account. A direct identification of the deposit account is determined from the indirect identification and from a nonpublic mapping of a indirect identifications to identifications of respective deposit accounts. An instruction is issued to credit the deposit account with the specified amount in accordance with the determined direct identification.

Owner:FIRST DATA

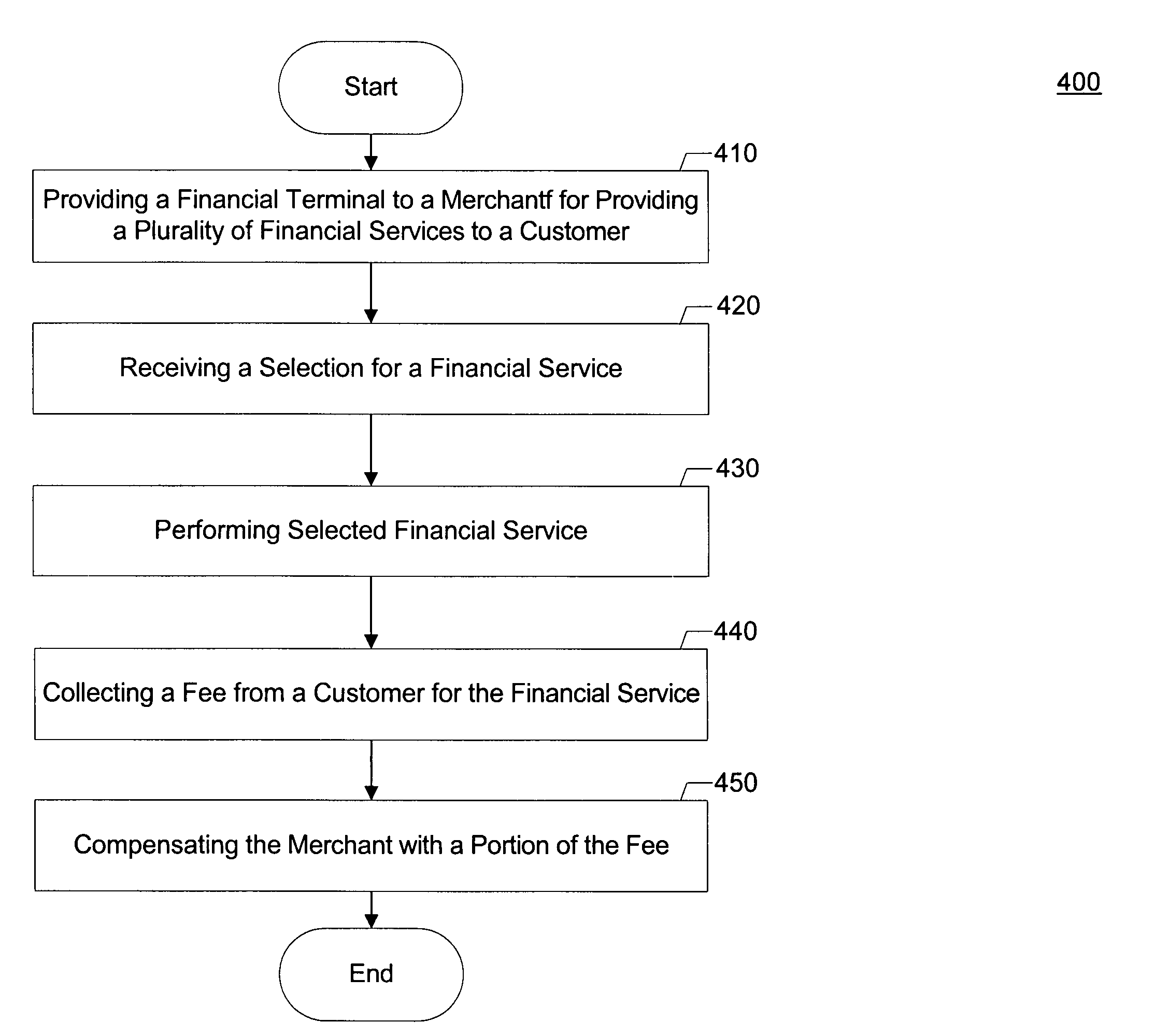

System, method and apparatus for providing financial services

The present invention is a system, method and apparatus for a terminal capable of accepting debit / credit or ATM cards, checks, money orders, cashiers checks, travelers checks, as well as a drivers license, state identification card, birth certificate and additionally any type of information that may be inputted into the terminal such as, but not limited to, an individuals direct deposit account (DDA) number, savings account number, etc. to facilitate a purchase, transfer of funds, wire of funds, cash-back option, etc. at a merchant location. In addition, the present invention will allow an individual to purchase pre-paid credit-type cards, pre-paid telecom cards, stamps, etc. at the terminal.

Owner:COMPUCREDIT INTPROP HLDG CORP II

Transfer Account Systems, Computer Program Products, And Associated Computer-Implemented Methods

ActiveUS20090164350A1Low interest rateReduce riskComplete banking machinesFinanceDirect depositDatabase

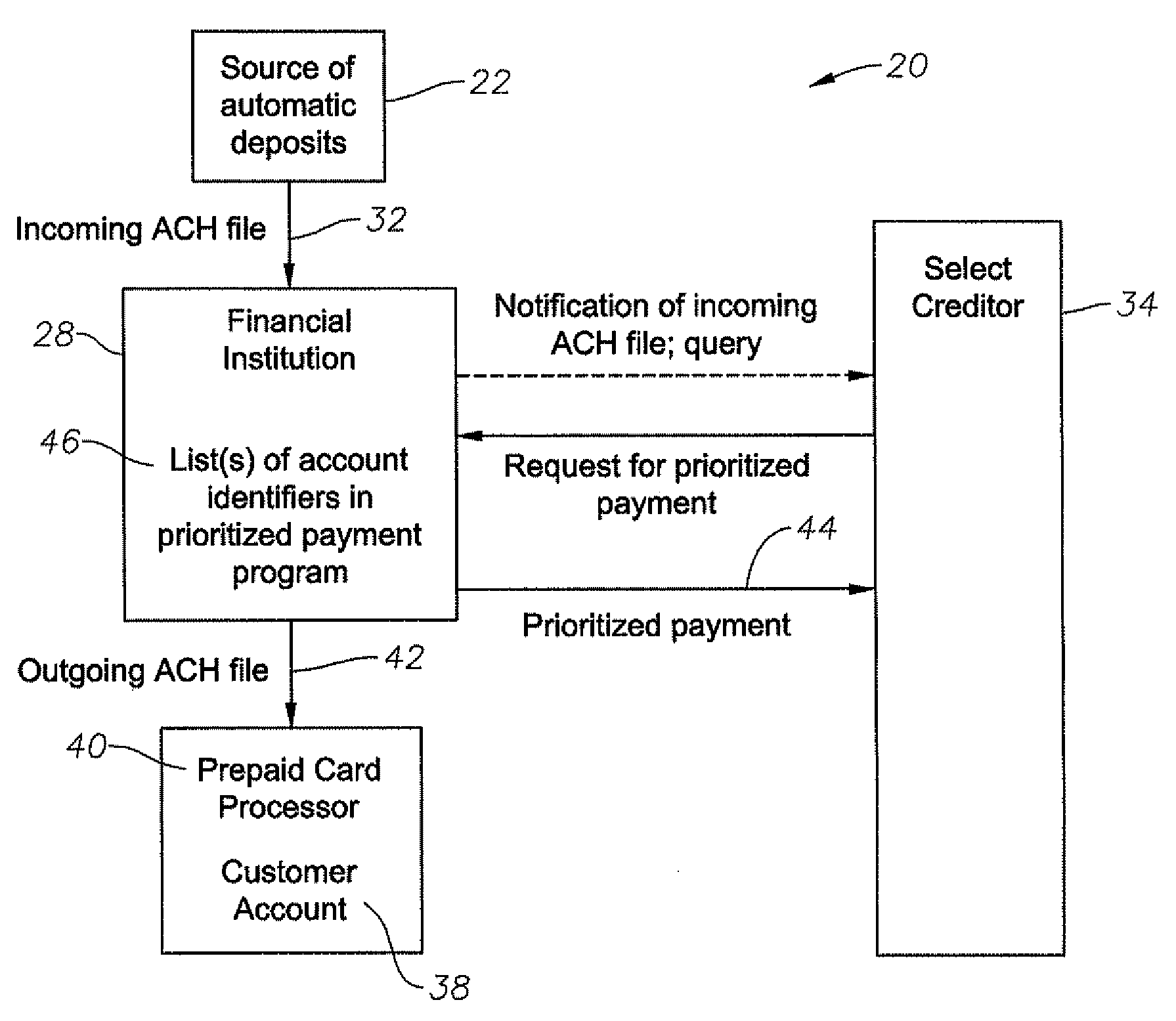

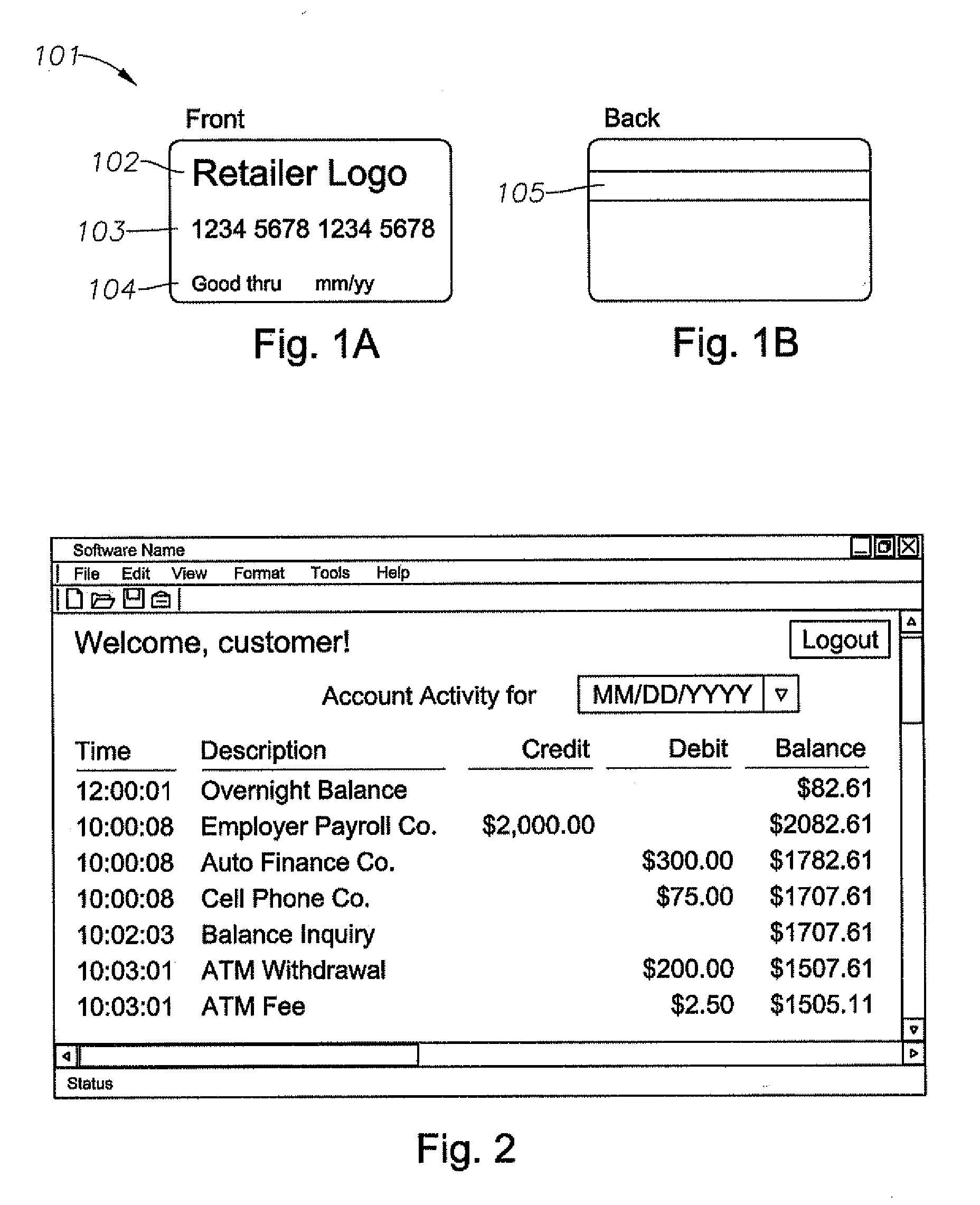

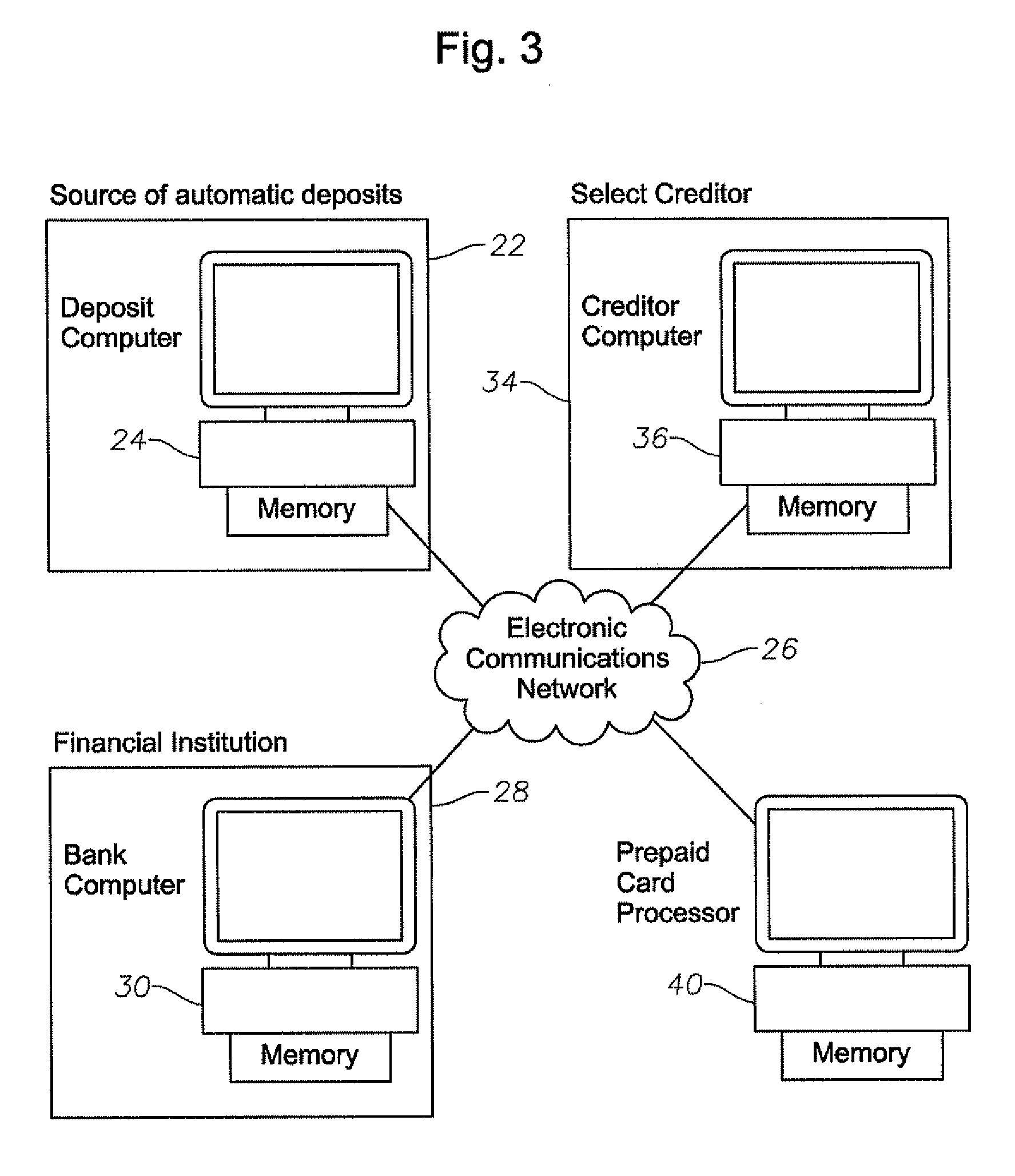

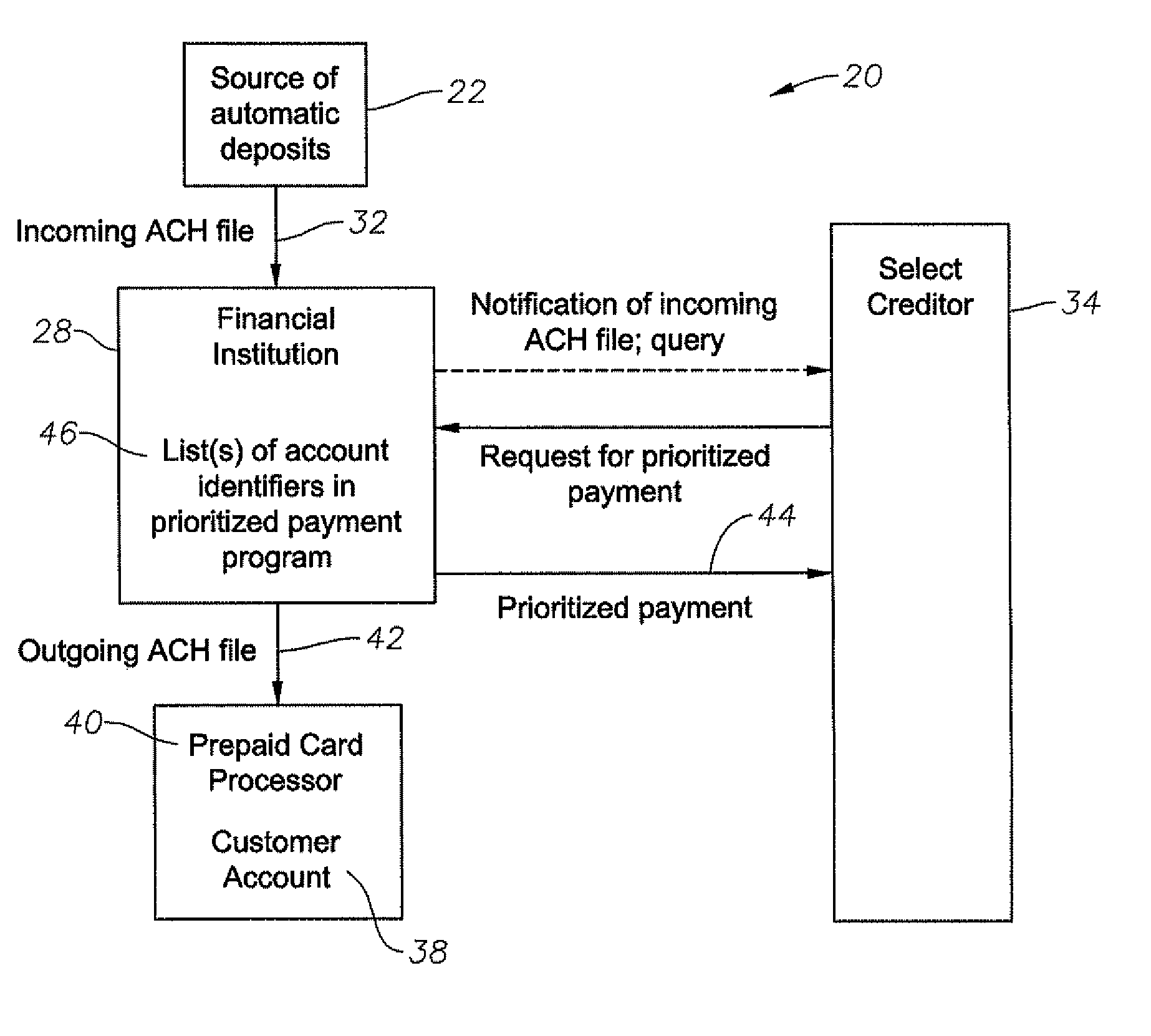

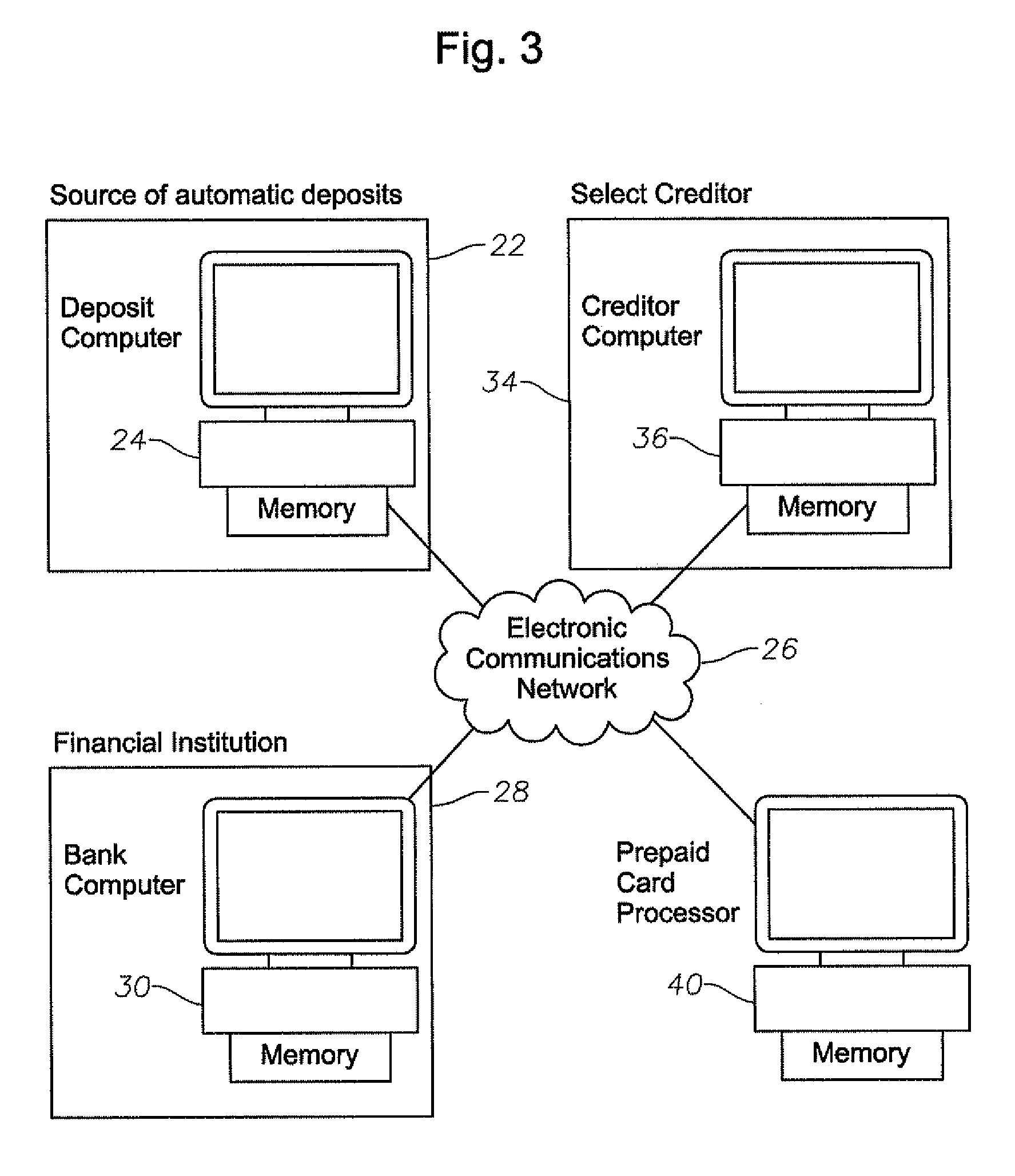

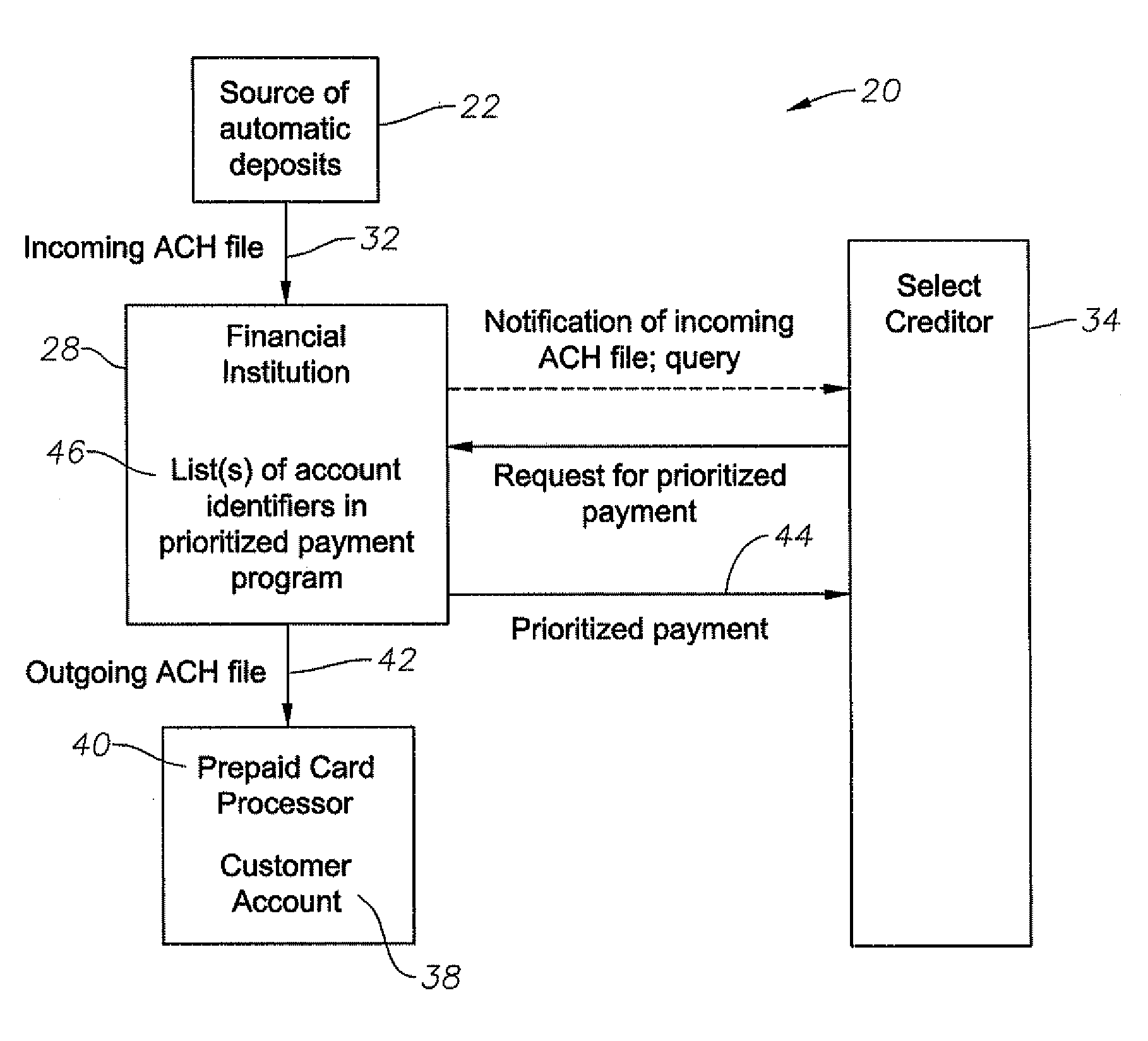

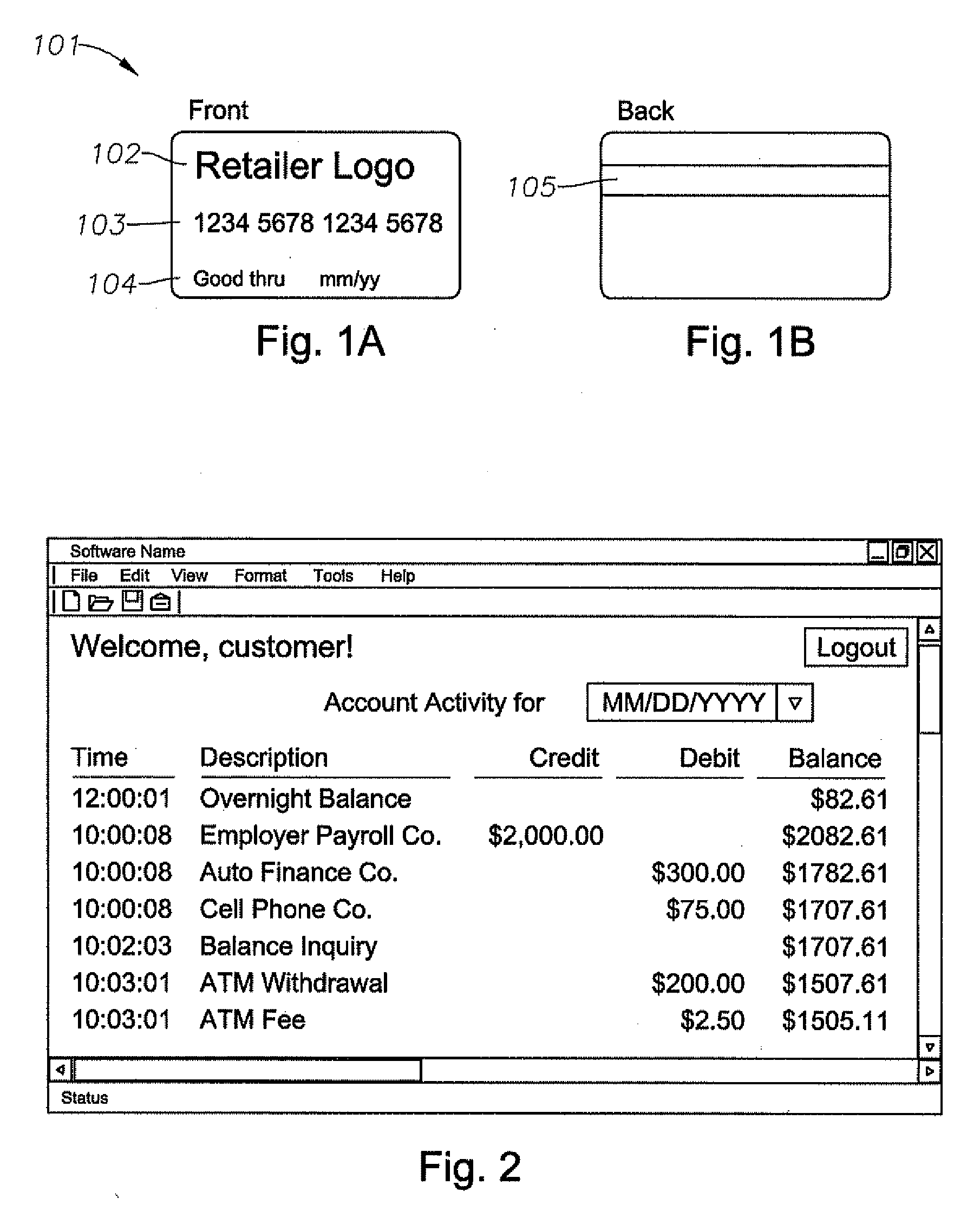

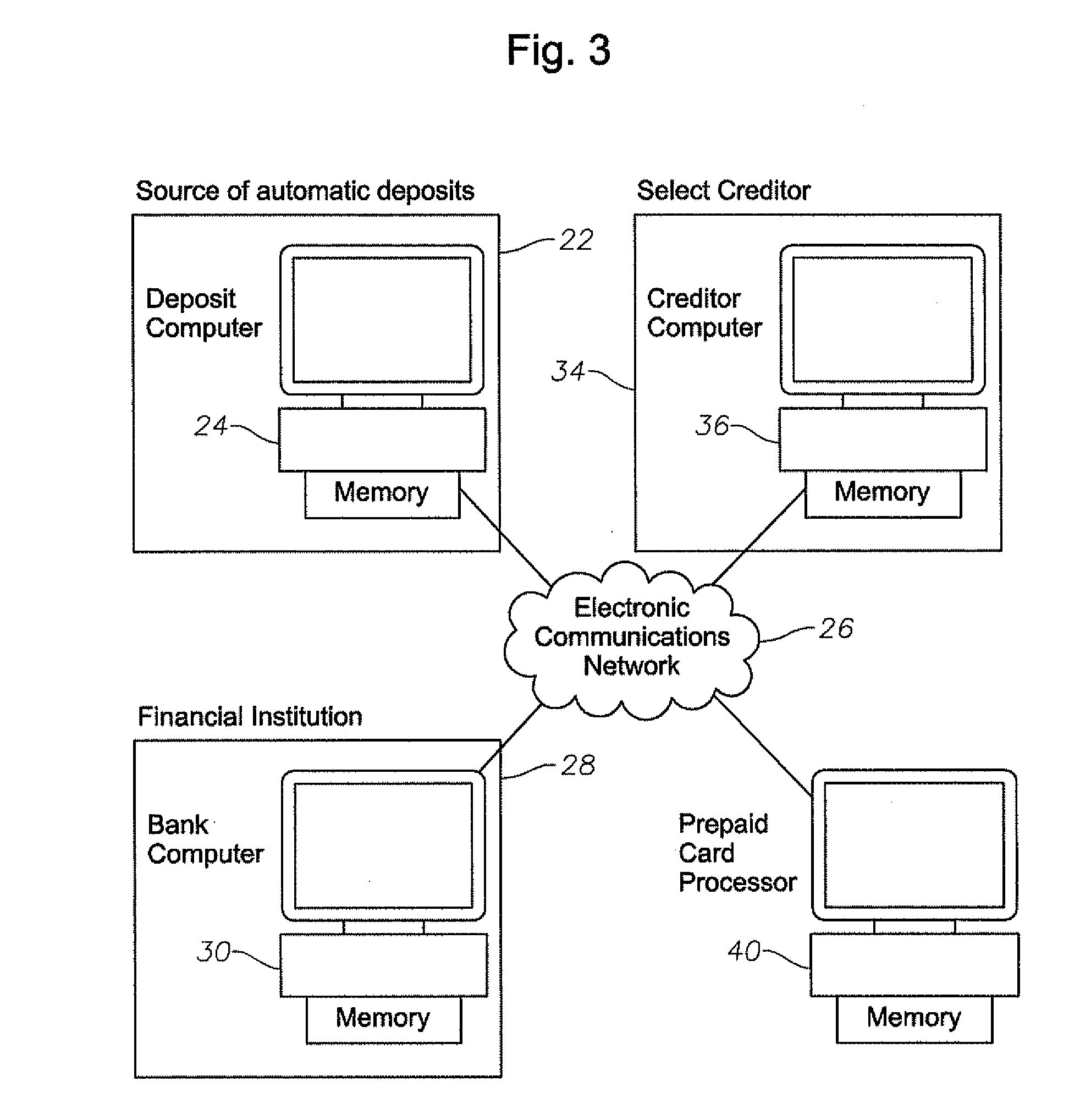

Embodiments of the present invention include transfer account systems, computer program products, and associated computer-implemented methods of providing prioritized payments from the proceeds of automatic or direct deposits. Embodiments of the present invention include routing automatic deposit information to a financial institution computer managing a prioritized payment program and formulating an outgoing ACH file with both an entry for an automatic deposit destined for a customer account and an entry for a pre-authorized prioritized payment to a select creditor, so that the automatic deposit is credited to the customer account and relatively instantaneously any prioritized payment is debited from the customer account. According to embodiments of the present invention, the customer account can be a prepaid card account so that a customer has effective access on the prepaid card only to a net value of funds.

Owner:PATHWARD NAT ASSOC

Credit underwriting based on paper instrument

A credit underwriting technique that allows a consumer to gain early access to funds for paying bills or conducting financial transactions contingent upon the consumer having a high-degree of reliability on the reception of future funds, and / or the granting of access to at least a portion of the funds represented by the future funds when received. The access can be in the form of a paper check that is issued from an account in which the paycheck is deposited, an electronic fund transfer from the same account, or a direct deposit of the paycheck into either a lender accessible account or into the lenders account directly. The access can be applied for aggregated financial transactions or can be periodically applied for recurring transactions.

Owner:COMPUCREDIT INTPROP HLDG CORP II

Transfer account systems, computer program products, and associated computer-implemented methods

ActiveUS8055557B2Reduce riskImprove the customer's payment historyComplete banking machinesFinanceComputer scienceDirect deposit

Embodiments of the present invention include transfer account systems, computer program products, and associated computer-implemented methods of providing prioritized payments from the proceeds of automatic or direct deposits. Embodiments of the present invention include routing automatic deposit information to a financial institution computer managing a prioritized payment program and formulating an outgoing ACH file with both an entry for an automatic deposit destined for a customer account and an entry for a pre-authorized prioritized payment to a select creditor, so that the automatic deposit is credited to the customer account and relatively instantaneously any prioritized payment is debited from the customer account. According to embodiments of the present invention, the customer account can be a prepaid card account so that a customer has effective access on the prepaid card only to a net value of funds.

Owner:PATHWARD NAT ASSOC

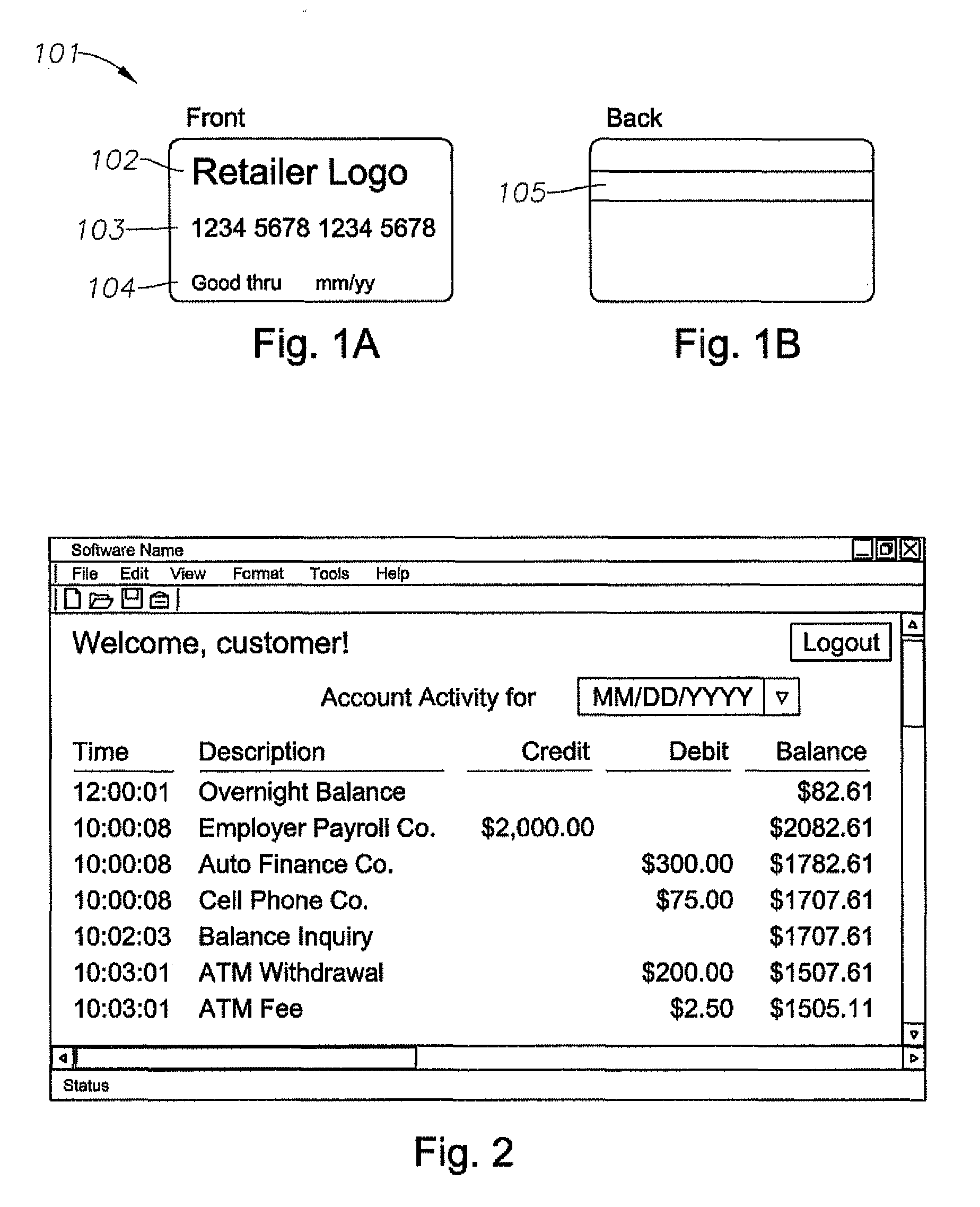

Card-based system and method for issuing negotiable instruments

A card-based system for a non-bank entity to indirectly provide direct deposit capabilities for funds representing pre-payments for negotiable instruments. When a direct deposit of funds into a first account associated with the individual and maintained by a first entity is detected, the total amount of the funds is transferred into a second account associated with the individual and maintained by a second entity. The first entity is a bank or other financial institution subject to federal banking regulations, while the second entity is not subject to federal banking regulations. The individual may withdraw the funds from the second account by using a card at an ATM or POS terminal requesting the issuance of negotiable instruments. Negotiable instruments may be issued in any dollar amount not exceeding the balance of the second account. A properly enrolled customer may make subsequent deposits into the second account. Security is provided by requiring the presentation of identify verification when the negotiable instruments are endorsed and cashed.

Owner:FIRST DATA +1

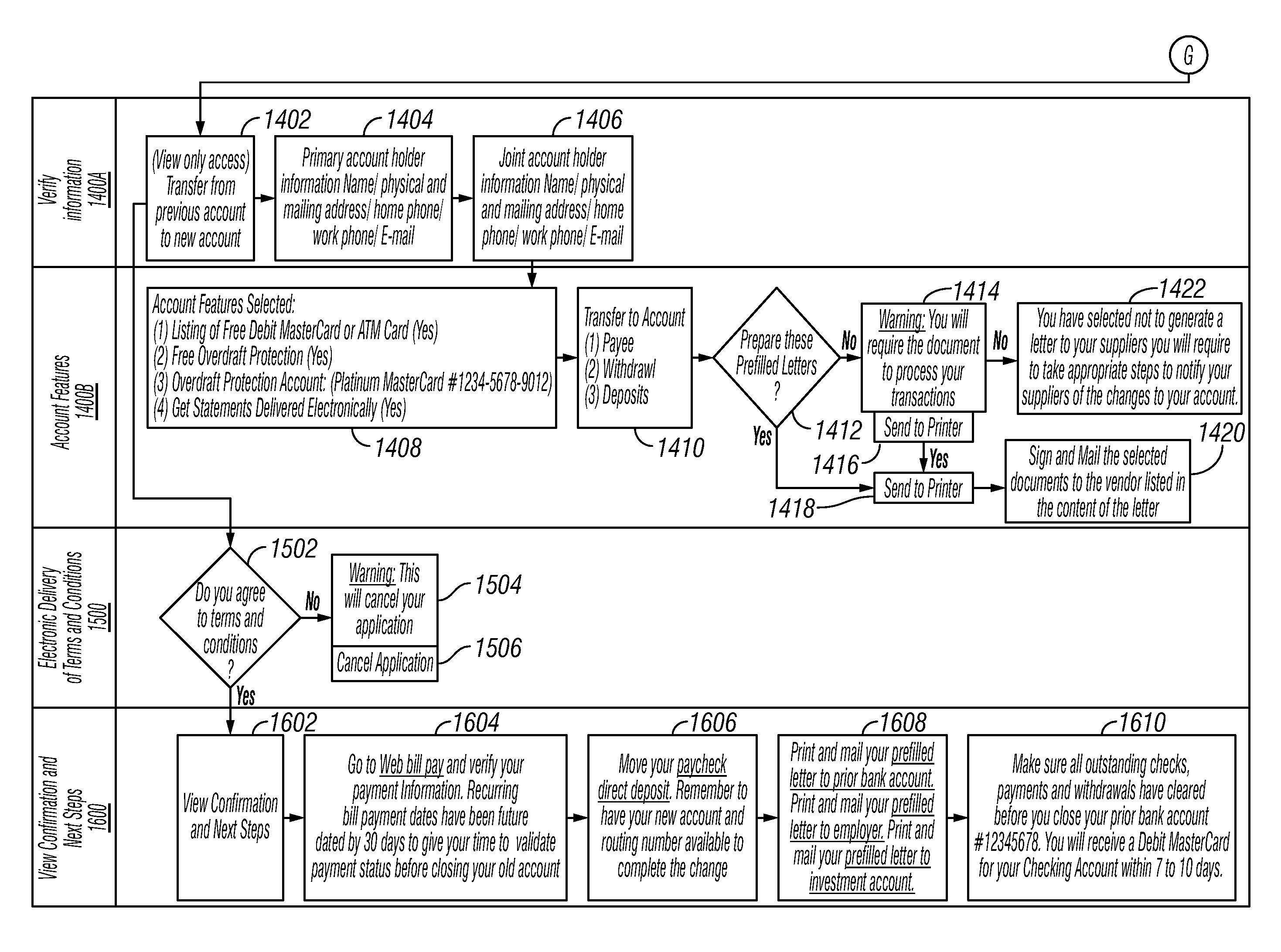

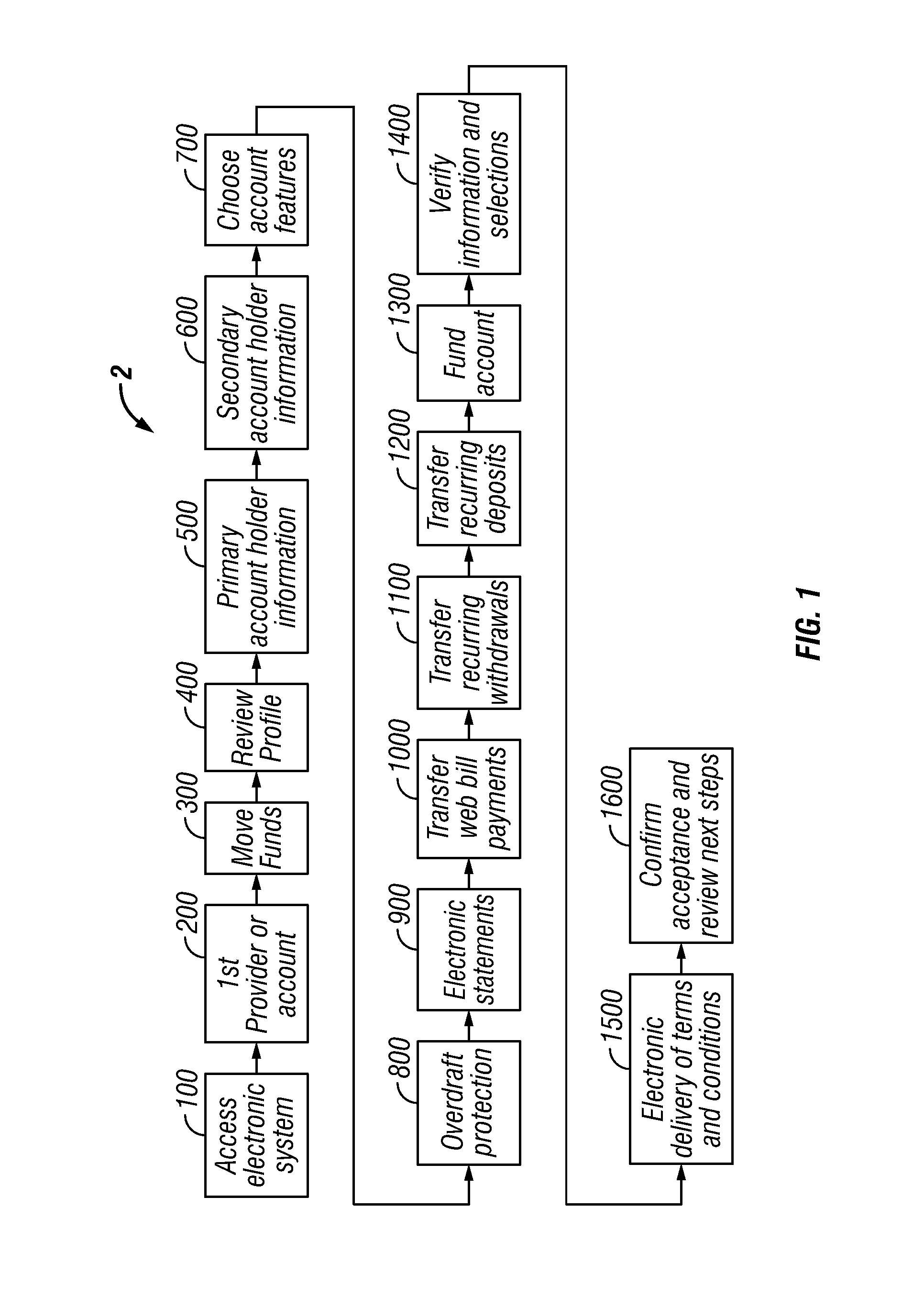

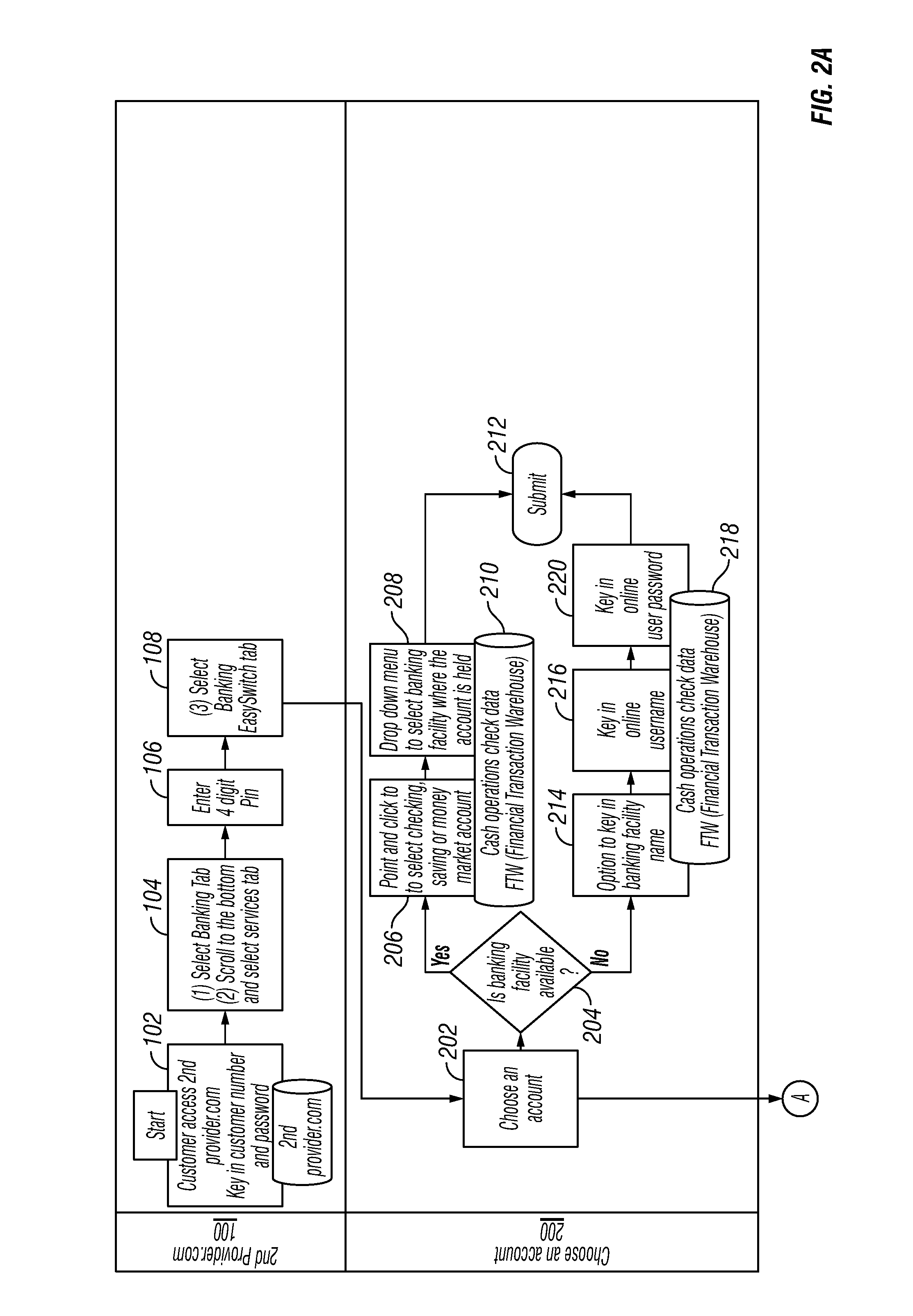

System and method for automated electronic switching of customer selected financial transactions for a customer banking account

The present disclosure provides a relatively automated system and method for a customer to change to a new service provider of a financial product, such as banking services. In general, the customer may provide initial data to a new second provider that the second provider may use to automatically and electronically access data about the customer from a prior first provider data source, such as an electronic database of the first provider. The customer data may include a customer credential provided to the second provider to retrieve automated financial transactions from the first provider's Web site on behalf of and with support of the customer. Automated financial transactions include direct deposits, automatic withdrawals, and online payment of bills. The second provider may use the data to at least partially recreate the automated financial transactions for the customer in an account with the second provider.

Owner:CLICKSWITCH HLDG INC

Transfer Account Systems, Computer Program Products, And Associated Computer-Implemented Methods

ActiveUS20090164351A1Reduce riskImprove the customer's payment historyComplete banking machinesFinanceChequeDirect deposit

Embodiments of the present invention include transfer account systems, computer program products, and associated computer-implemented methods of providing prioritized payments from the proceeds of automatic or direct deposits. Embodiments of the present invention include routing automatic deposit information to a financial institution computer managing a prioritized payment program and formulating an outgoing ACH file with both an entry for an automatic deposit destined for a customer account and an entry for a pre-authorized prioritized payment to a select creditor, so that the automatic deposit is credited to the customer account and relatively instantaneously any prioritized payment is debited from the customer account. According to embodiments of the present invention, the customer account can be a checking, deposit, savings, money market, or other account as understood by those skilled in the art, so that a customer has effective access through the customer account only to a net value of funds.

Owner:PATHWARD NAT ASSOC

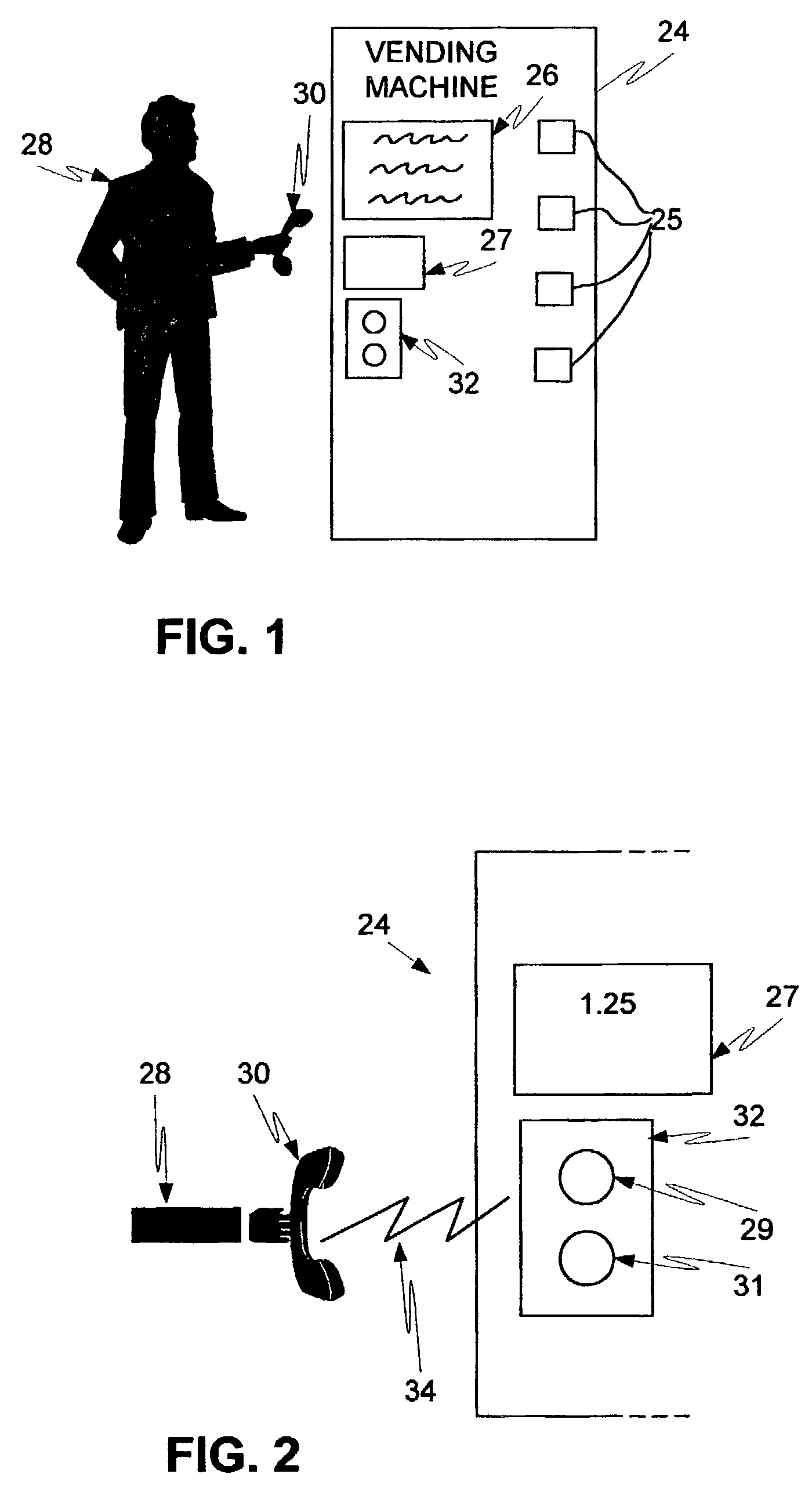

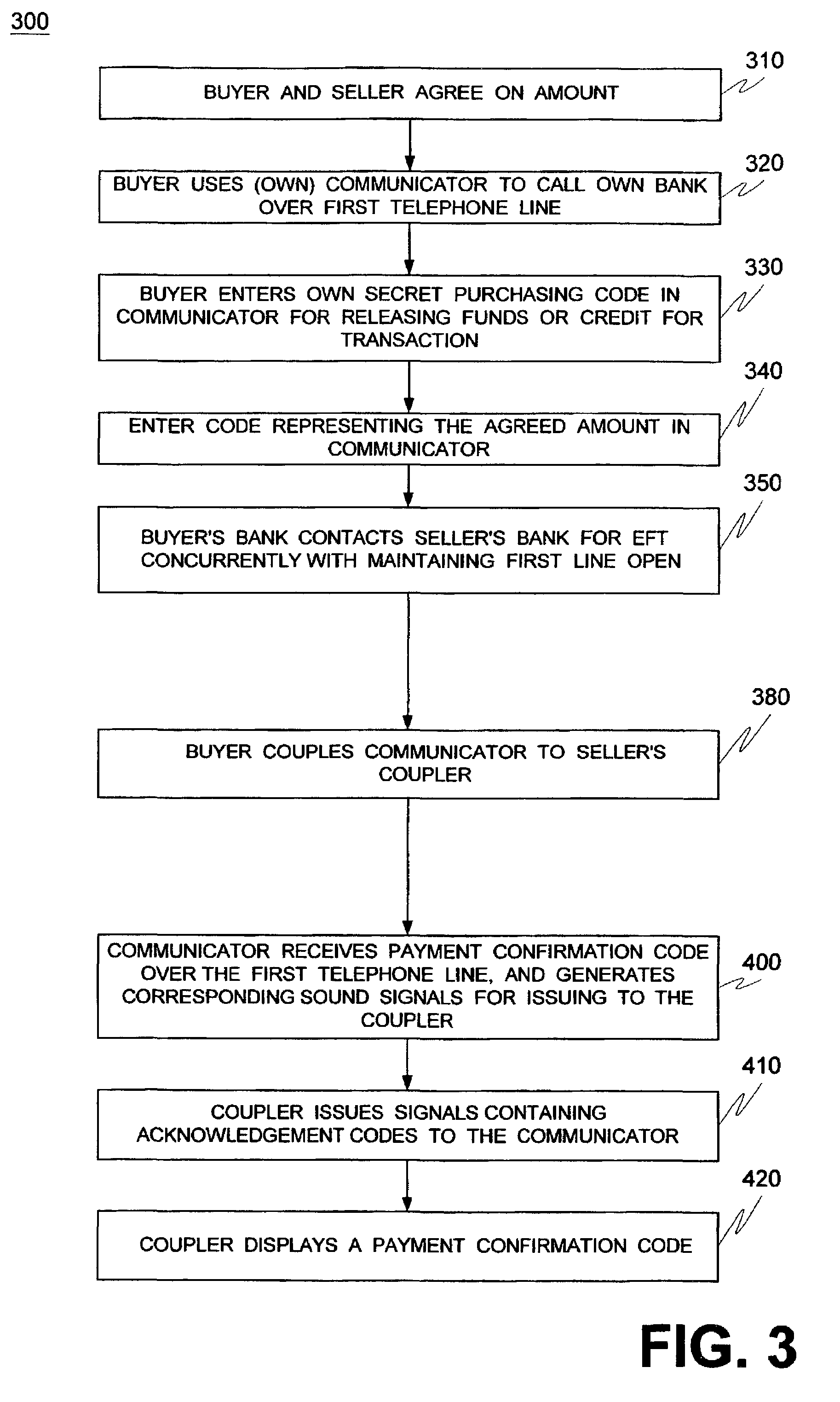

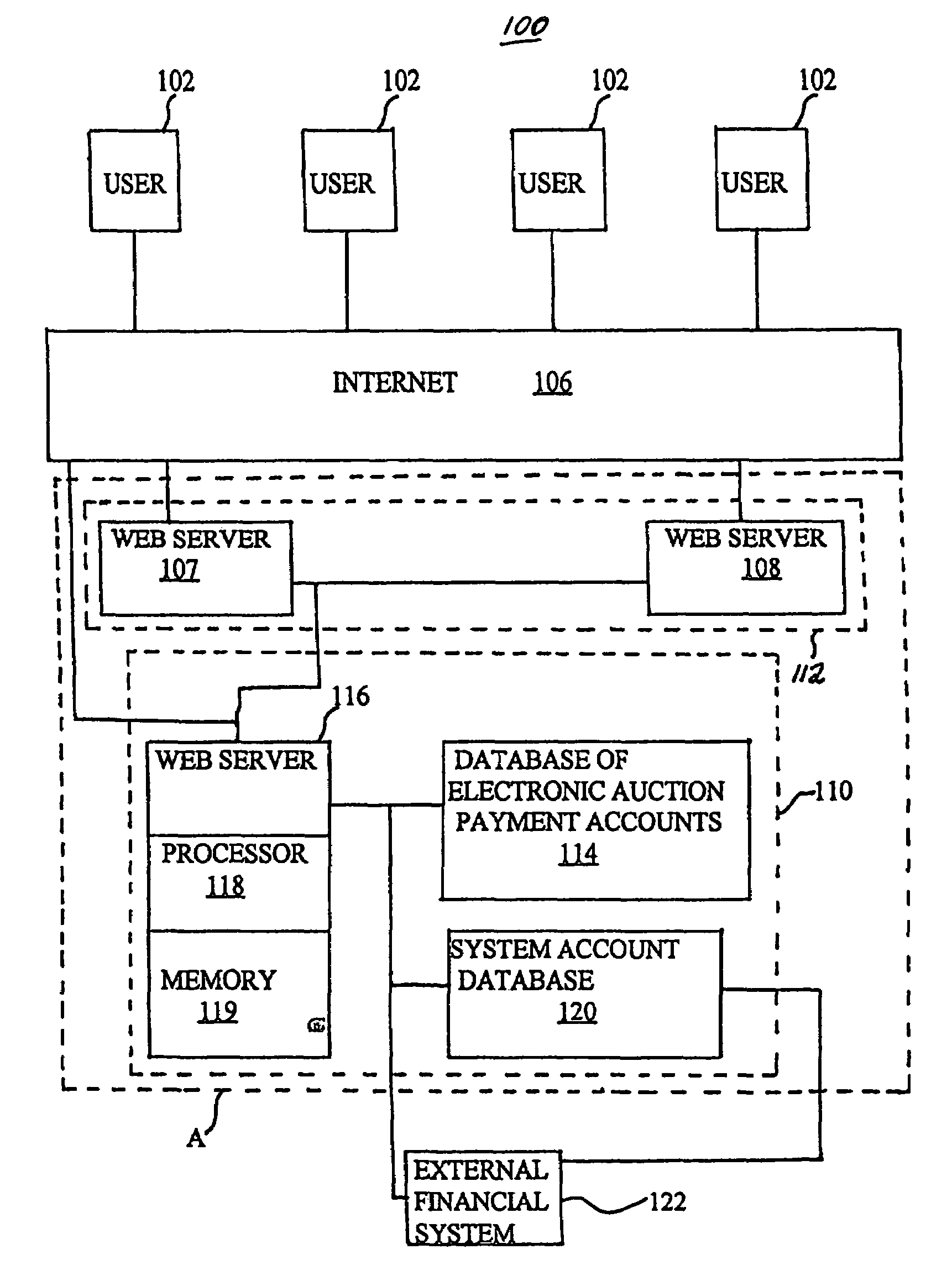

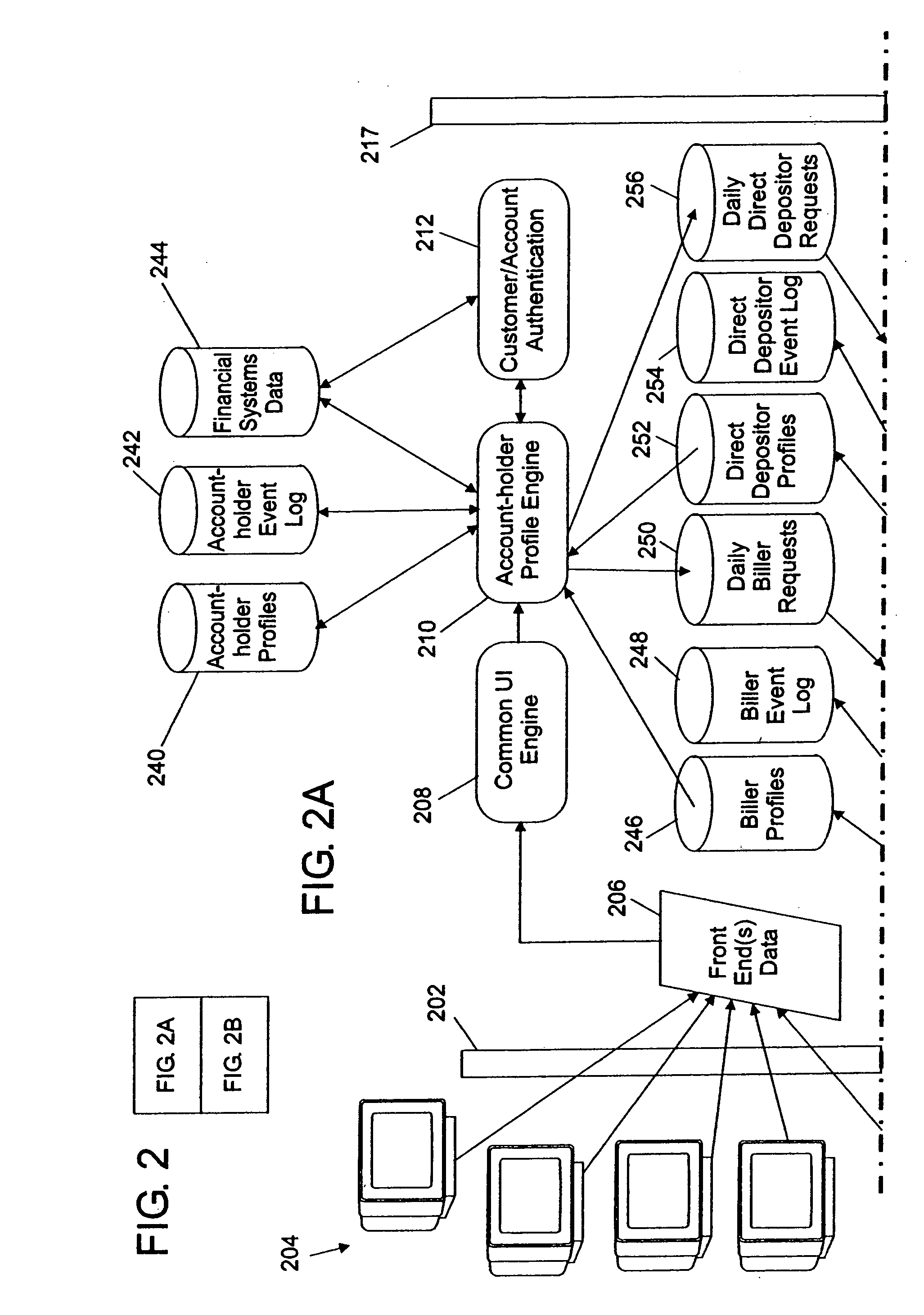

Methods, devices and bank computers for consumers using communicators to wire funds to sellers and vending machines

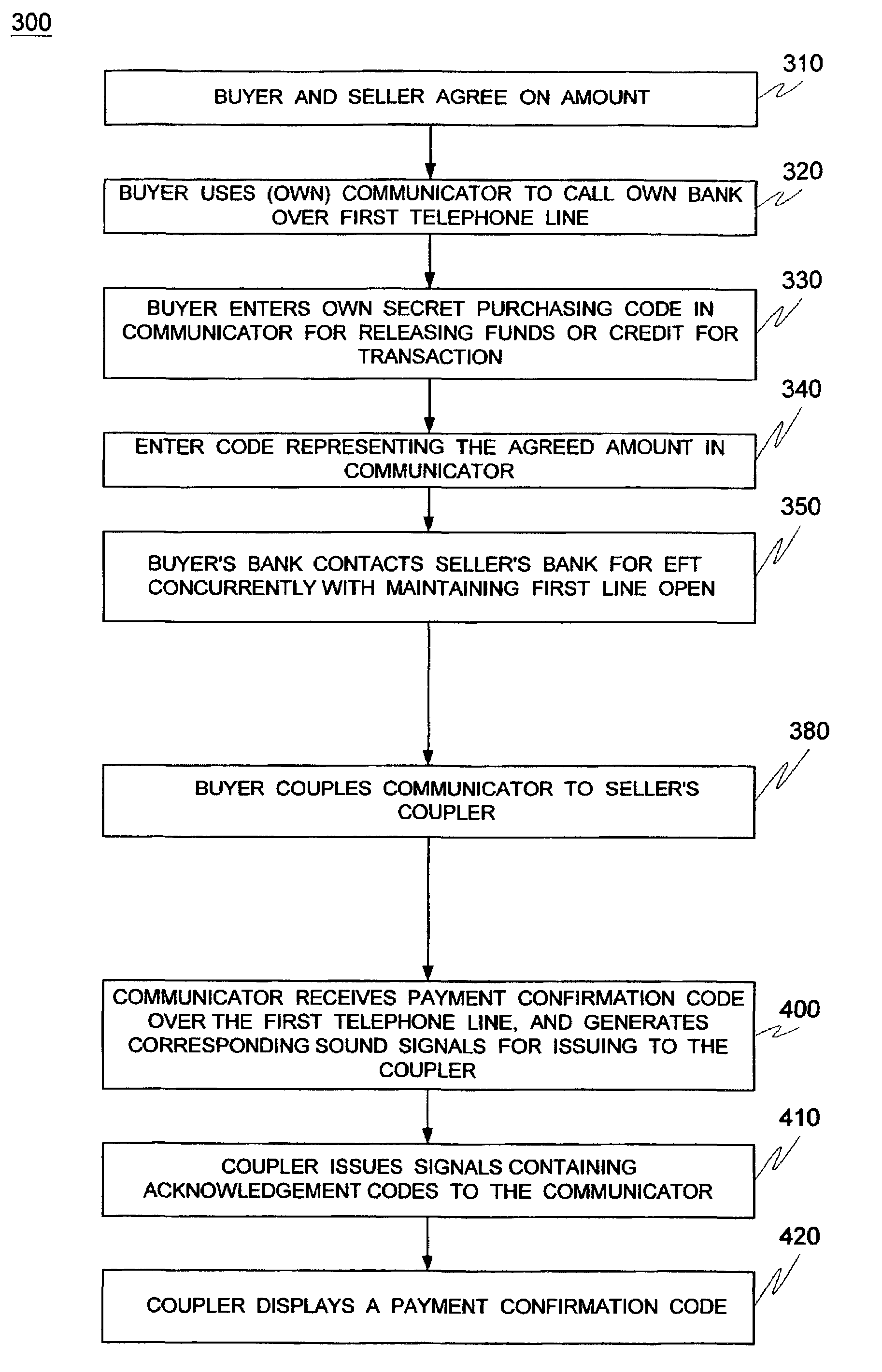

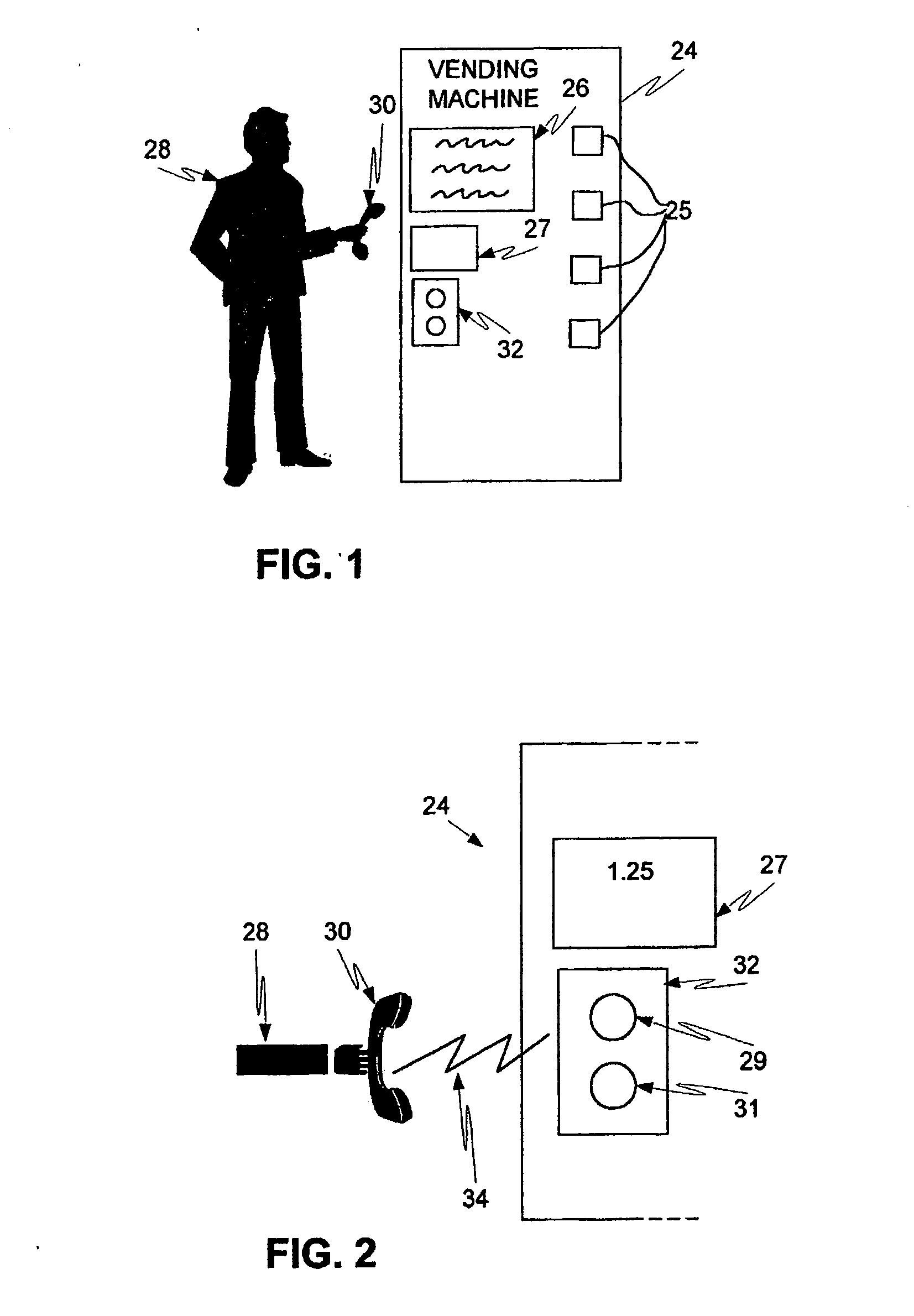

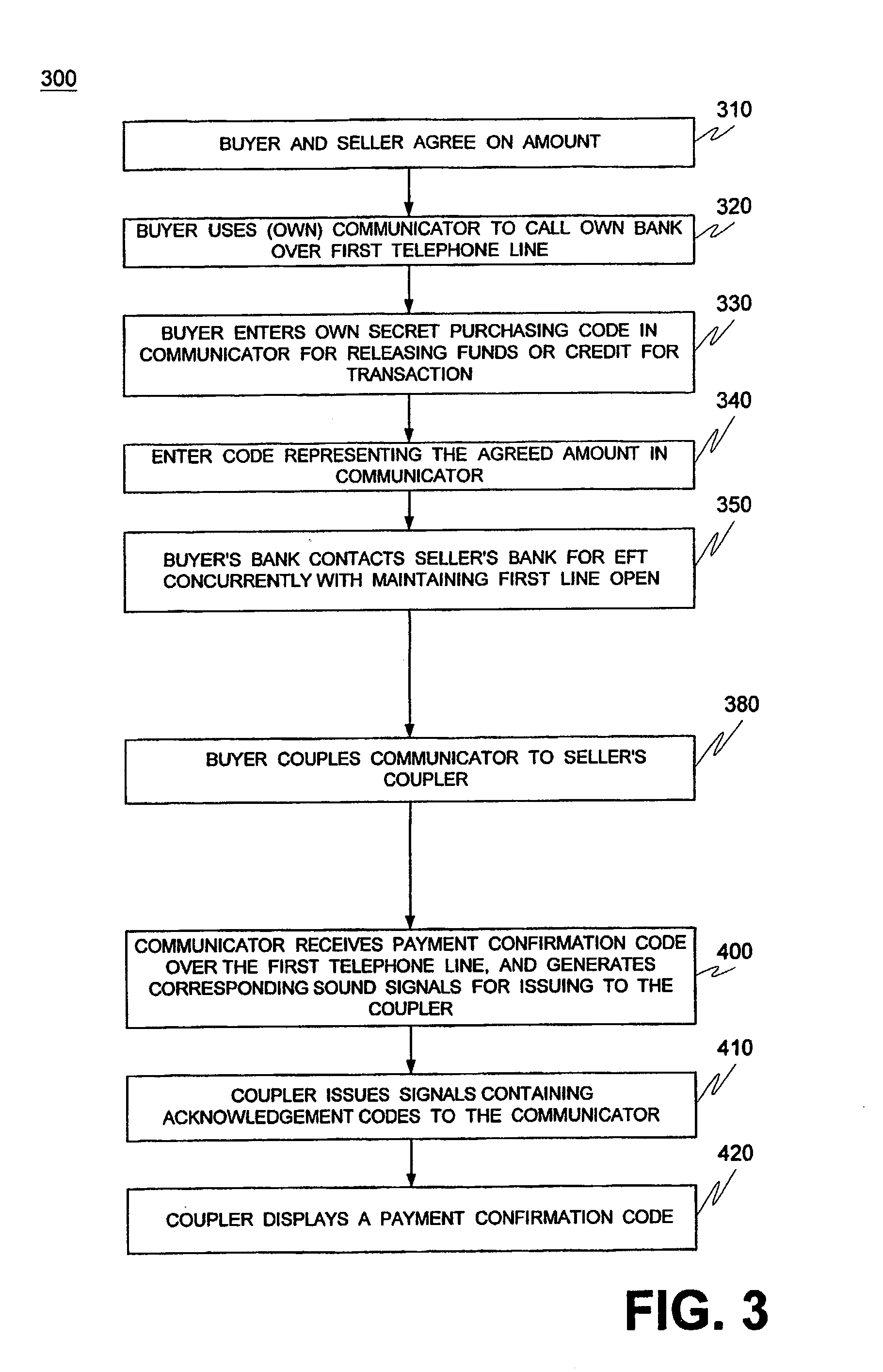

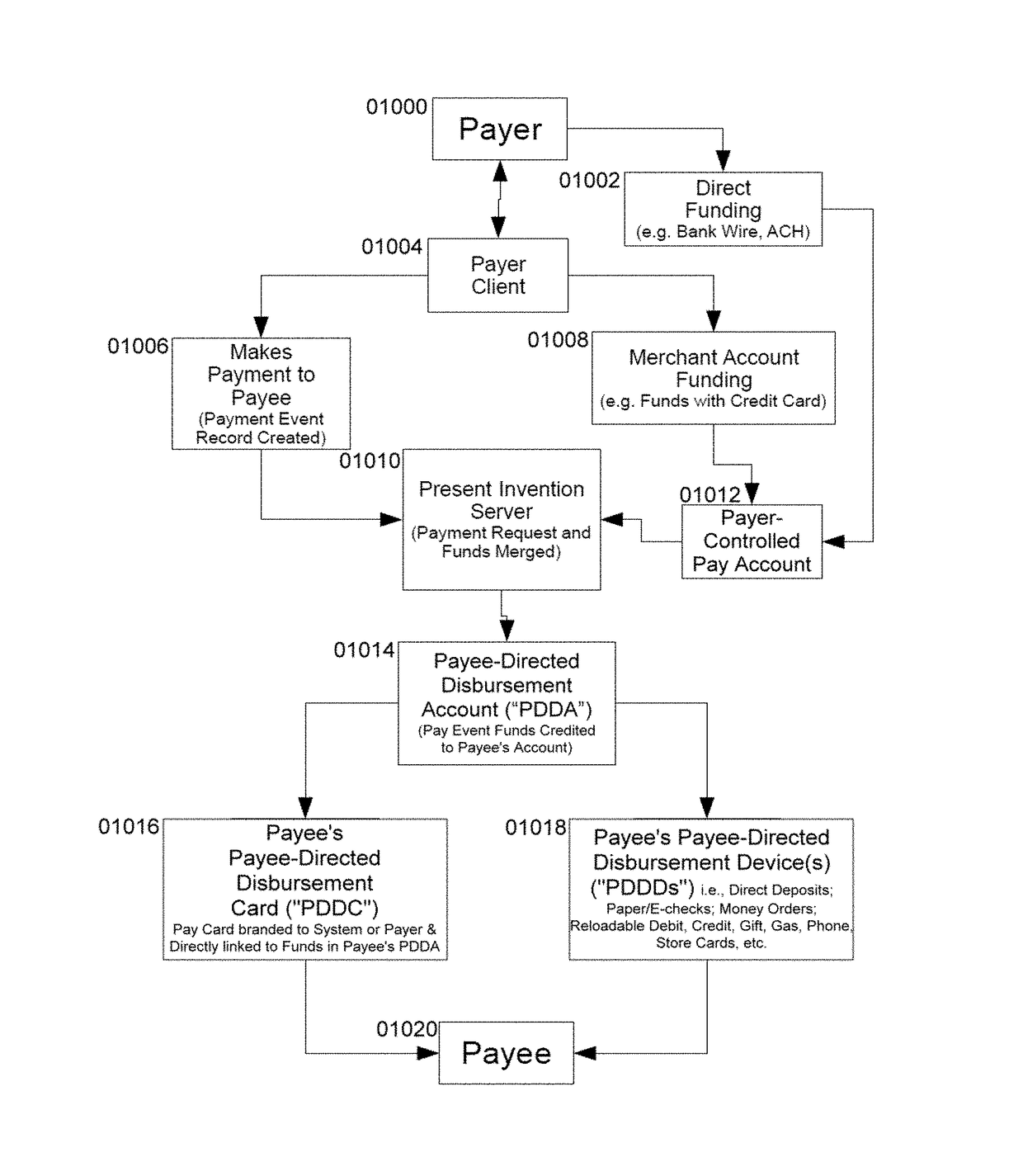

Methods for consumers to pay at the point of sale by using a personal communicator (30) to wire transfer funds (1364) out of their bank (40) account. The communicator (30) is coupled to, and exchanges signals with a reciprocating communicator (1350) of the seller, which in turn is coupled (1356) to the seller's bank (60). This way the money is transferred as an EFT payment code (1364) directly from the buyer's bank (40) to the seller's bank (60), where it may be considered direct deposited, without processing delays. Devices also include vending machines that can receive payment this way. Bank computers are provided with systems and software for enabling the above. The bank computers are accessible by telephone lines, and work with cooperating banks by exchanging signals, for transferring the funds. The seller's bank (60) generates a payment confirmation code (1368) that is ultimately transmitted to the seller's satisfaction for releasing the goods at the point of sale.

Owner:XYLON LLC

System and method to automate payment for a commerce transaction

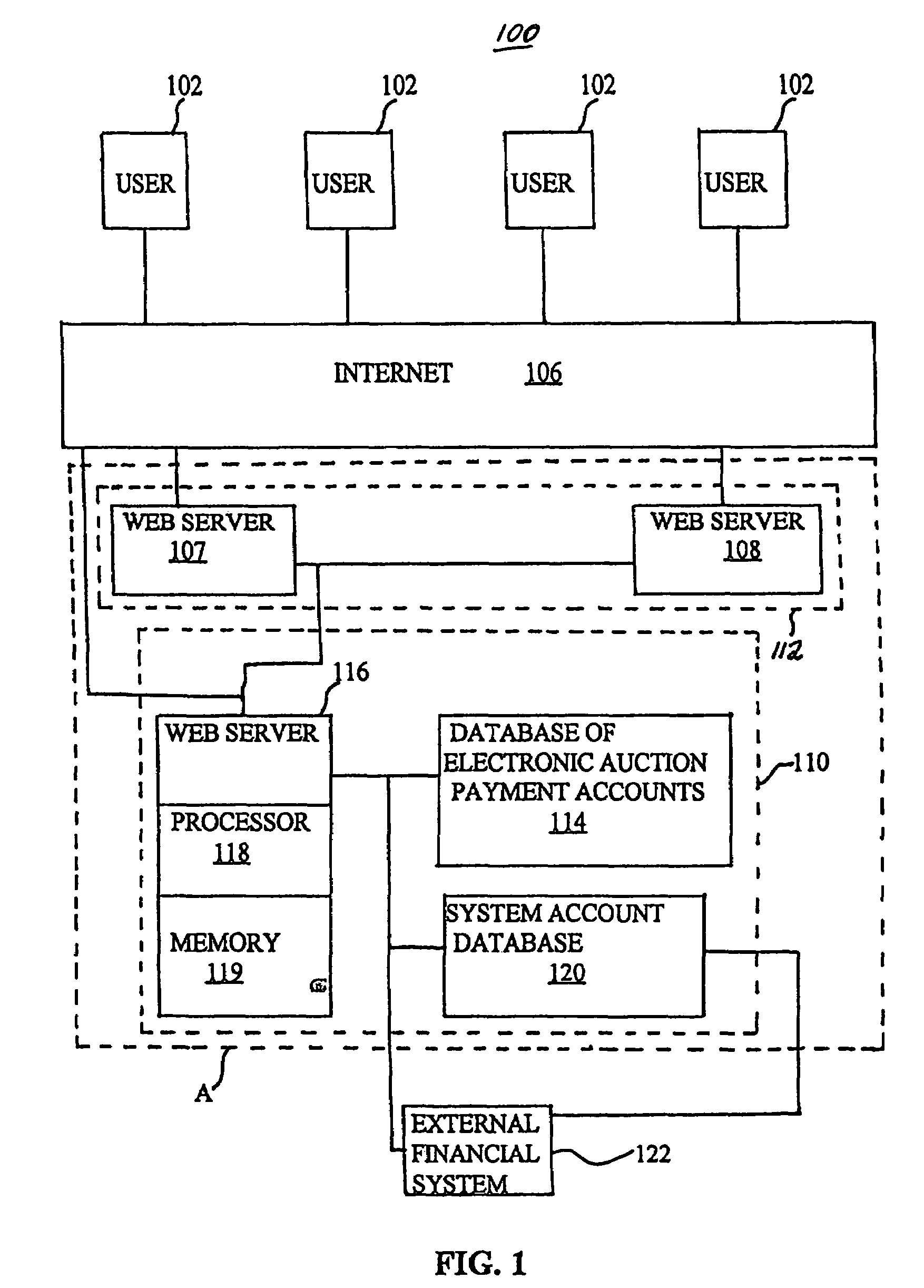

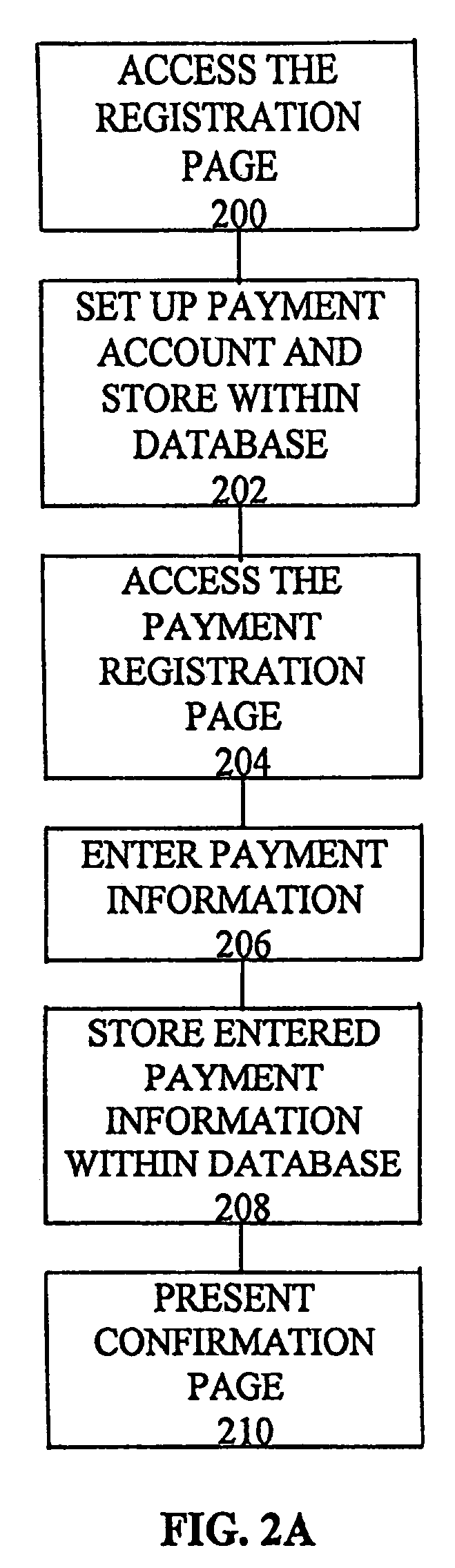

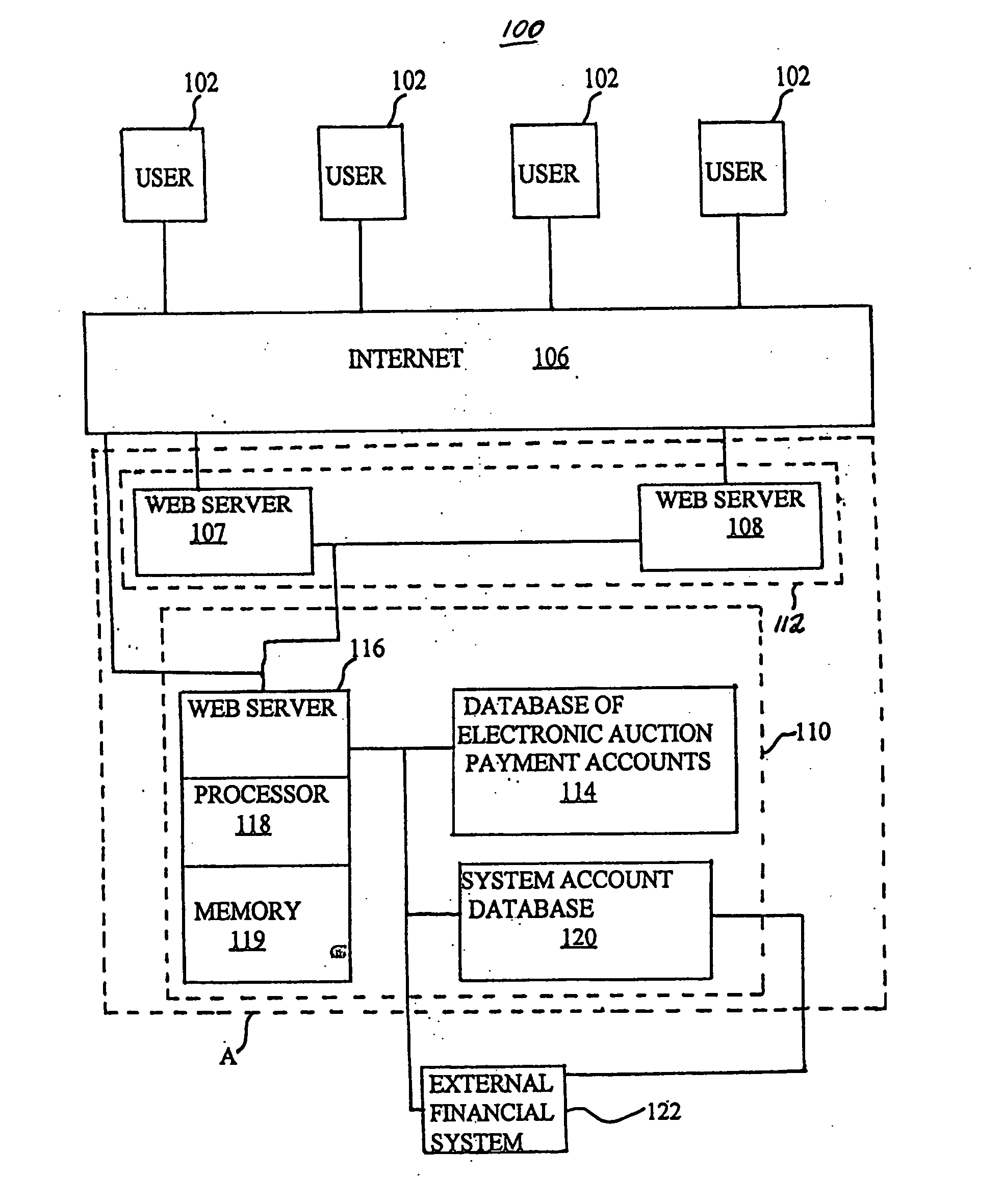

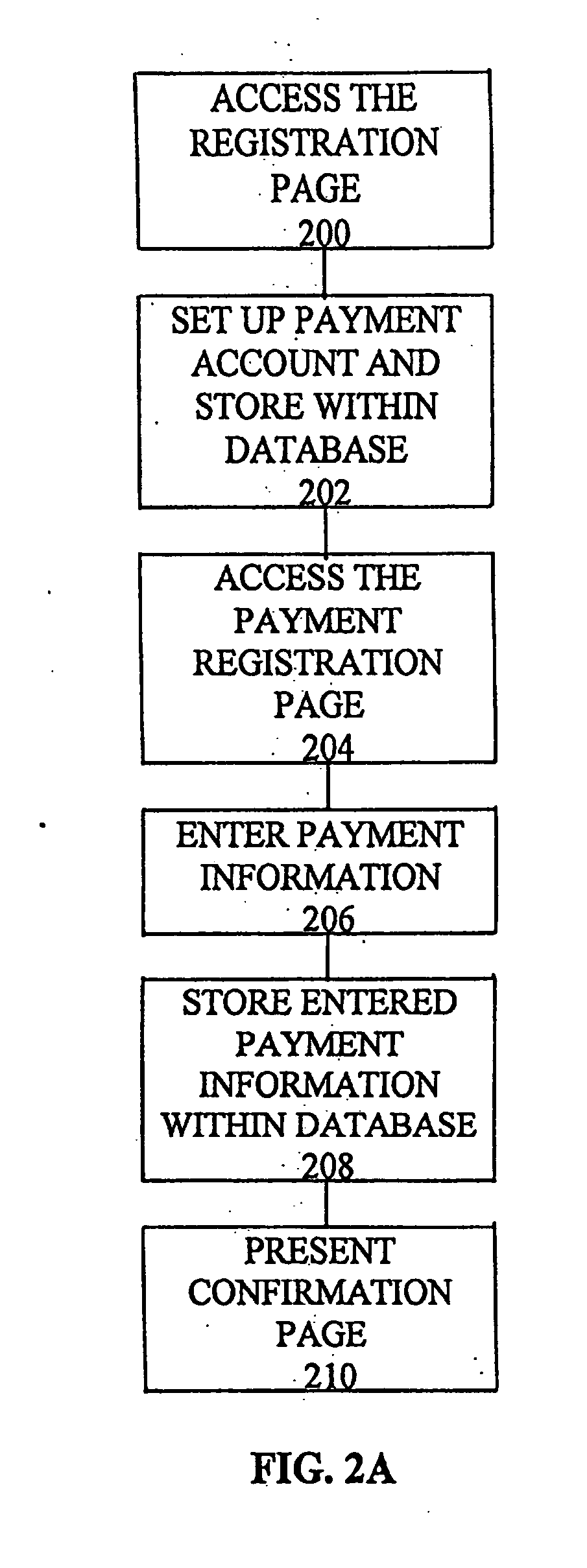

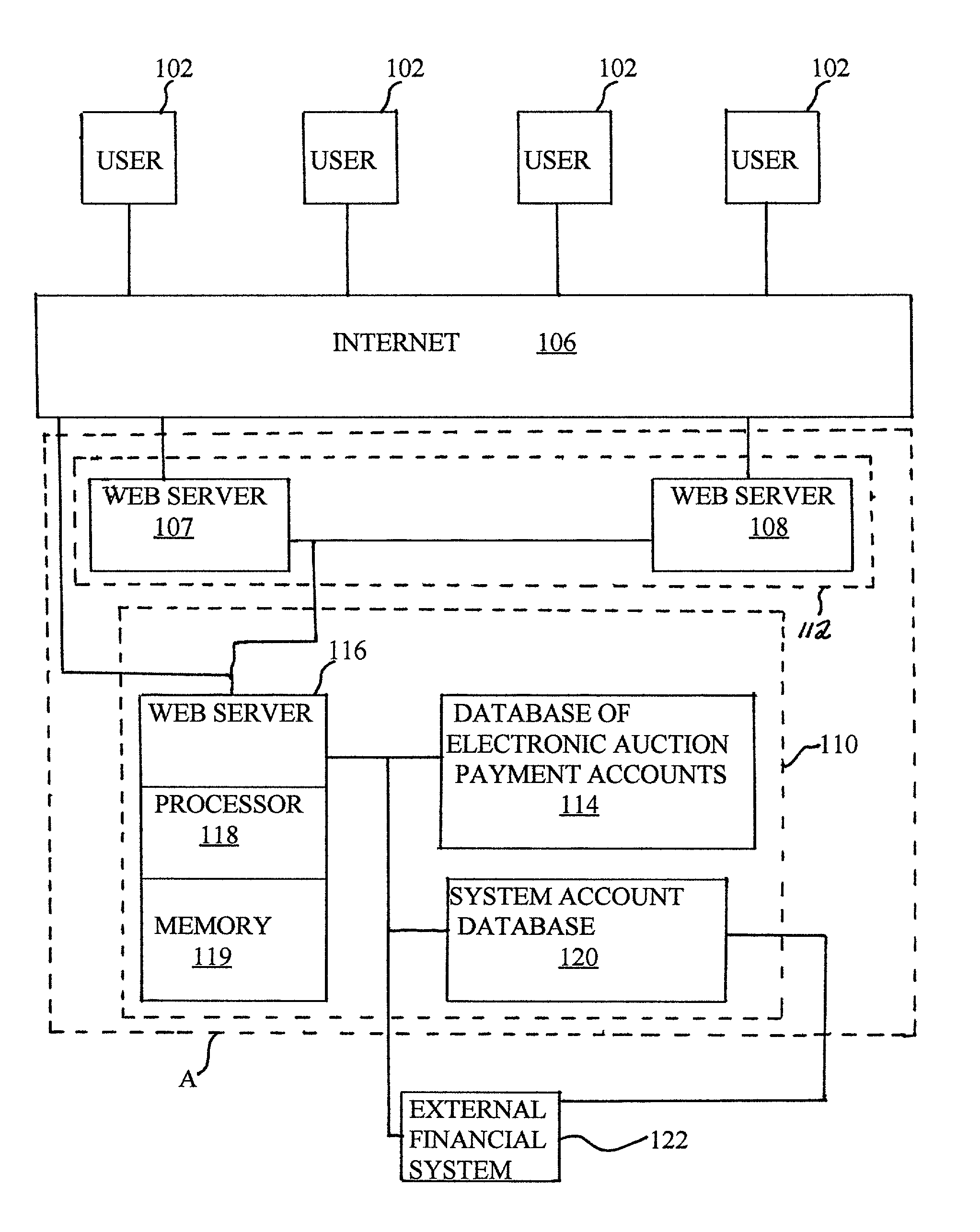

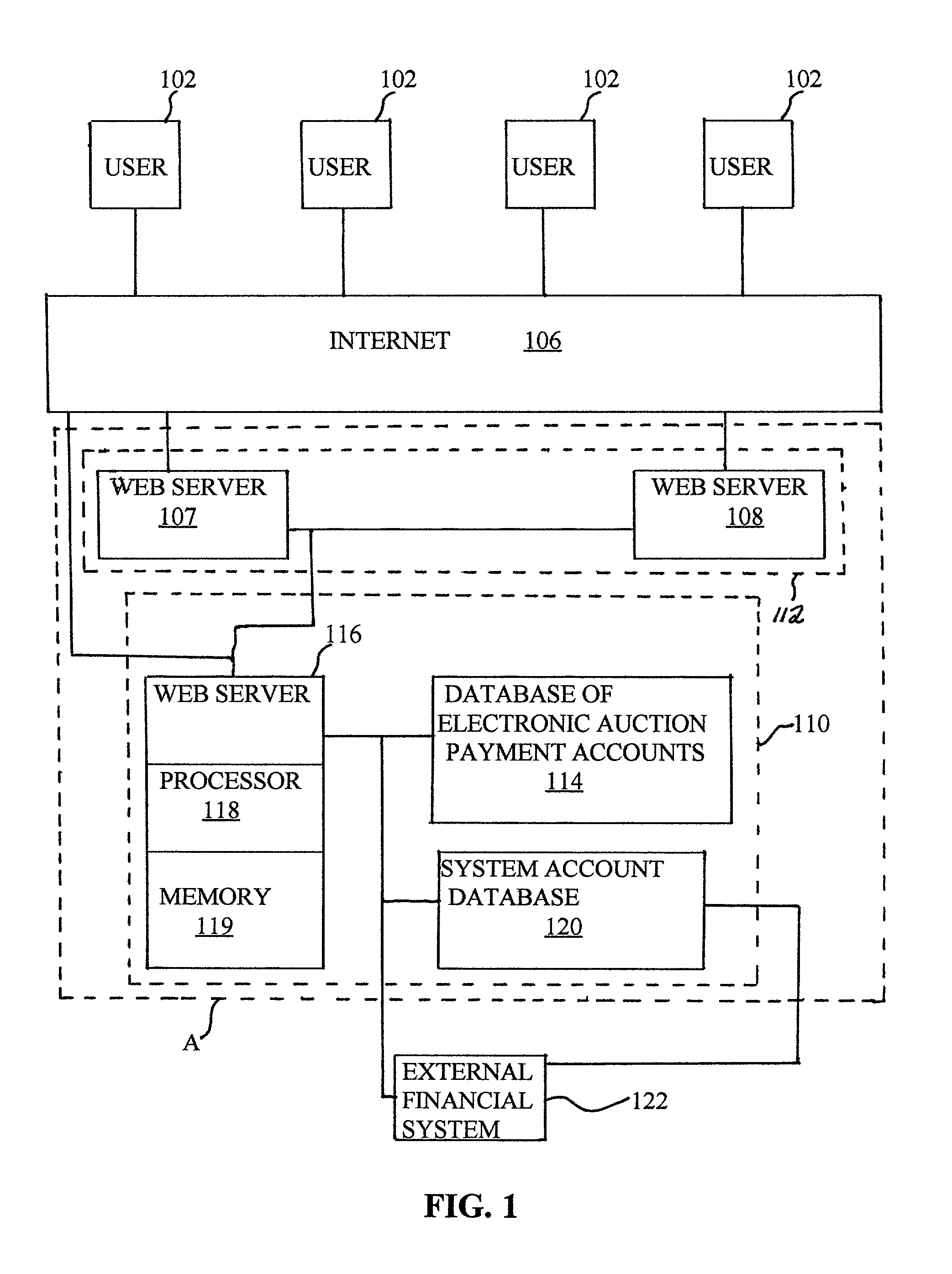

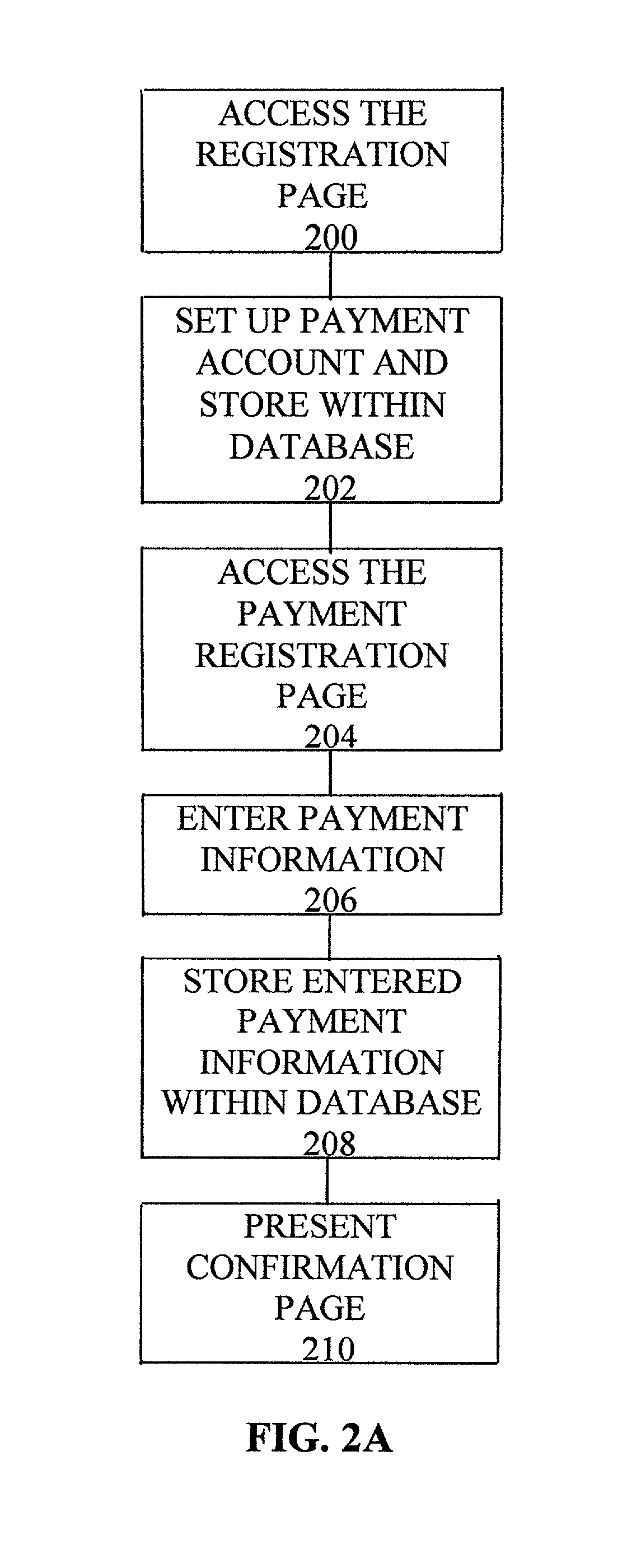

The invention provides a computerized electronic auction payment system and method for effecting a real-time payment for an item won in an electronic auction by setting up and maintaining electronic auction payment accounts for prospective bidders and sellers. The prospective bidders provide funds to their electronic auction payment accounts maintained by the computerized electronic auction payment system, prior to being deemed as winning bidders, via direct deposit, using a credit card, or sending a check, money order, or other financial document to an operator of the computerized electronic auction payment system. In one embodiment, upon being deemed as a winning bidder, the winning bidder accesses a payment page, enters the total amount of funds to be transferred to the seller, and authorizes the computerized electronic auction payment system to effect a real-time payment by debiting his, i.e., the winning bidder's, respective electronic auction payment account and crediting the electronic auction payment account of the seller, and / or another account specified by the seller. In an alternate embodiment, the prospective bidder authorizes the computerized electronic auction payment system to effect a real-time payment to the seller upon the prospective bidder being deemed the winning bidder (i.e., immediately following the conclusion of the auction). That is, without the winning bidder having to access the payment page.

Owner:XPRT VENTURES

System and method to automate payment for a commerce transaction

The invention provides a computerized electronic auction payment system and method for effecting a real-time payment for an item won in an electronic auction by setting up and maintaining electronic auction payment accounts for prospective bidders and sellers. The prospective bidders provide funds to their electronic auction payment accounts maintained by the computerized electronic auction payment system, prior to being deemed as winning bidders, via direct deposit, using a credit card, or sending a check, money order, or other financial document to an operator of the computerized electronic auction payment system. In one embodiment, upon being deemed as a winning bidder, the winning bidder accesses a payment page, enters the total amount of funds to be transferred to the seller, and authorizes the computerized electronic auction payment system to effect a real-time payment by debiting his, i.e., the winning bidder's, respective electronic auction payment account and crediting the electronic auction payment account of the seller, and / or another account specified by the seller. In an alternate embodiment, the prospective bidder authorizes the computerized electronic auction payment system to effect a real-time payment to the seller upon the prospective bidder being deemed the winning bidder (i.e., immediately following the conclusion of the auction). That is, without the winning bidder having to access the payment page.

Owner:XPRT VENTURES

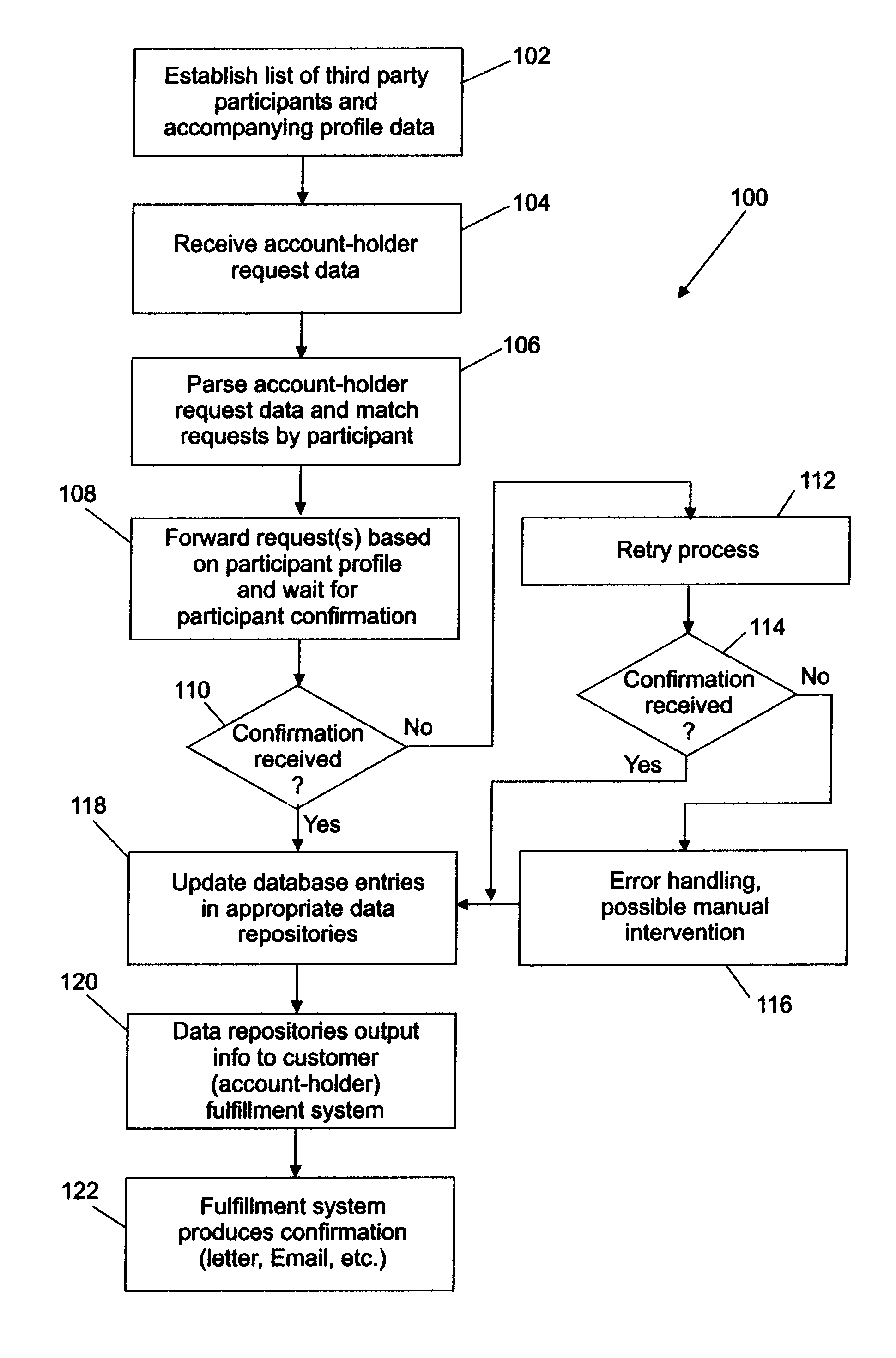

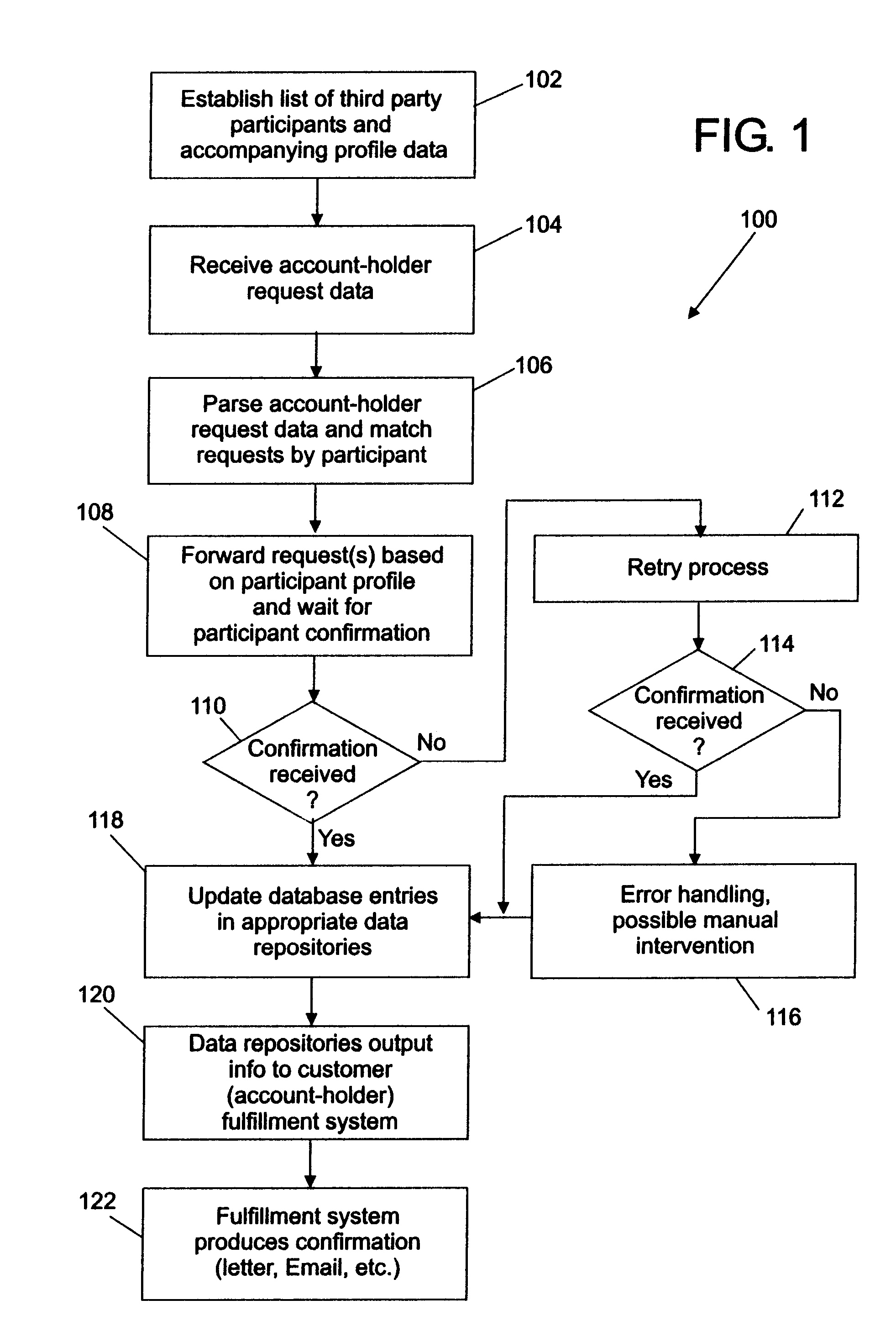

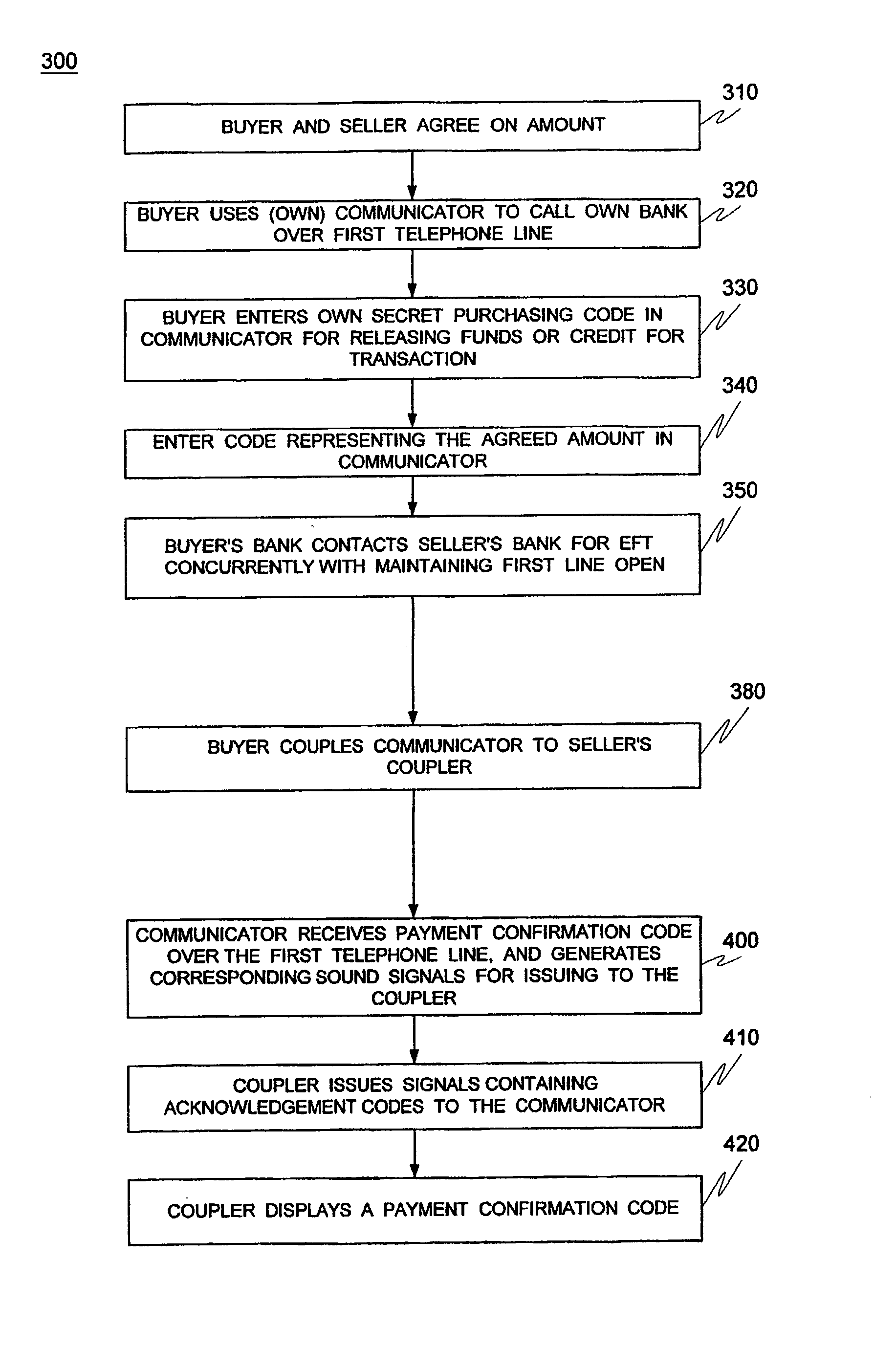

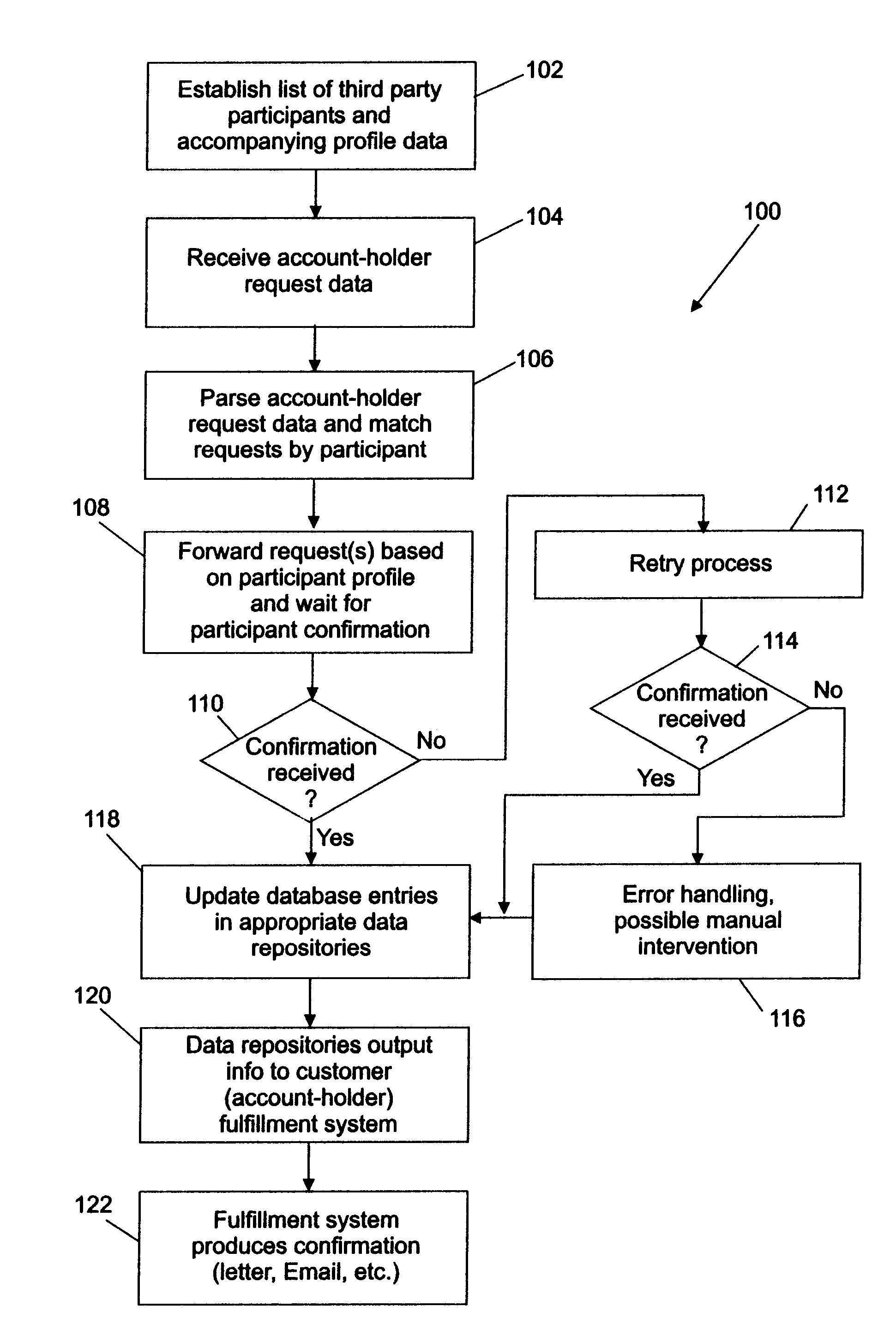

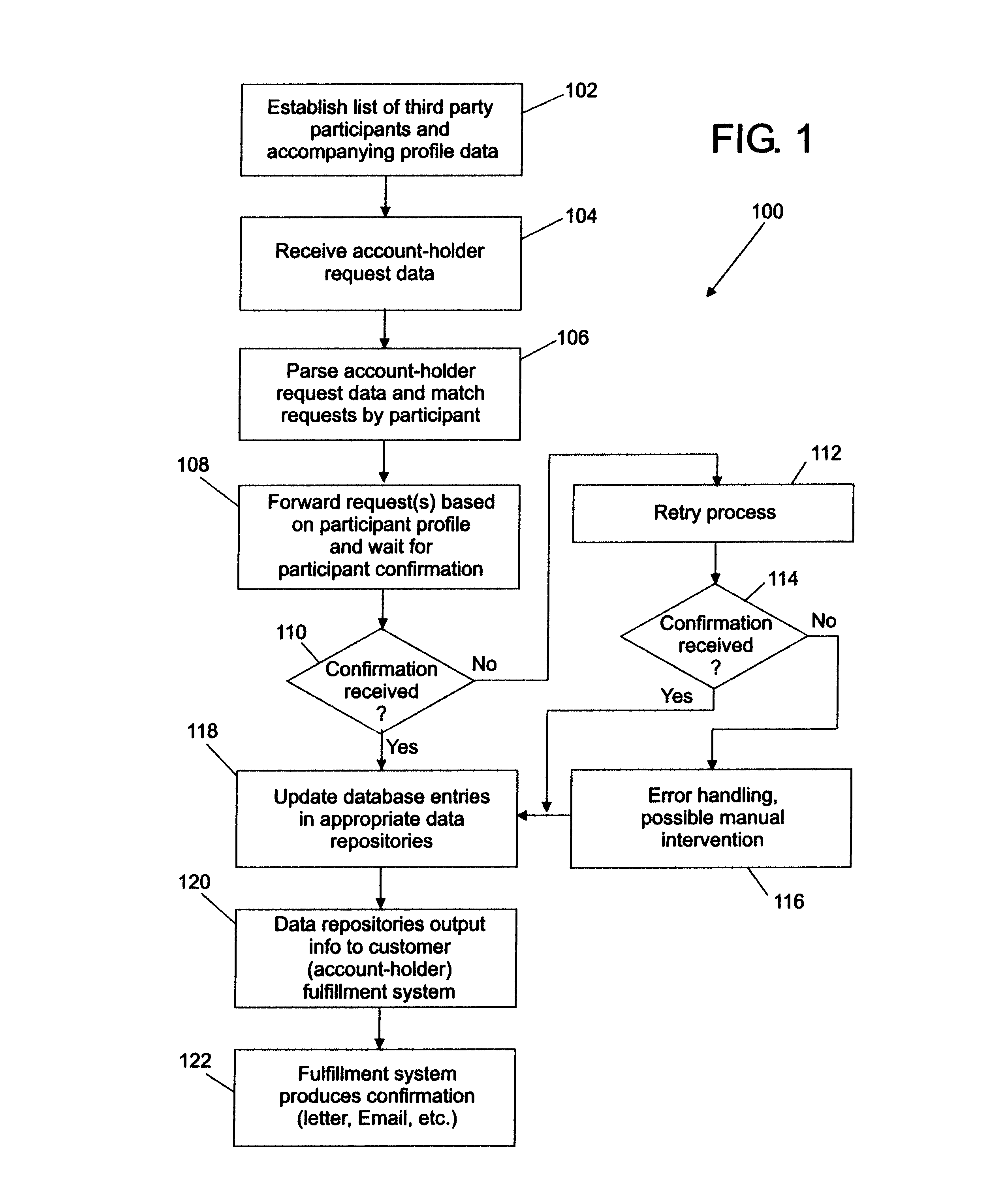

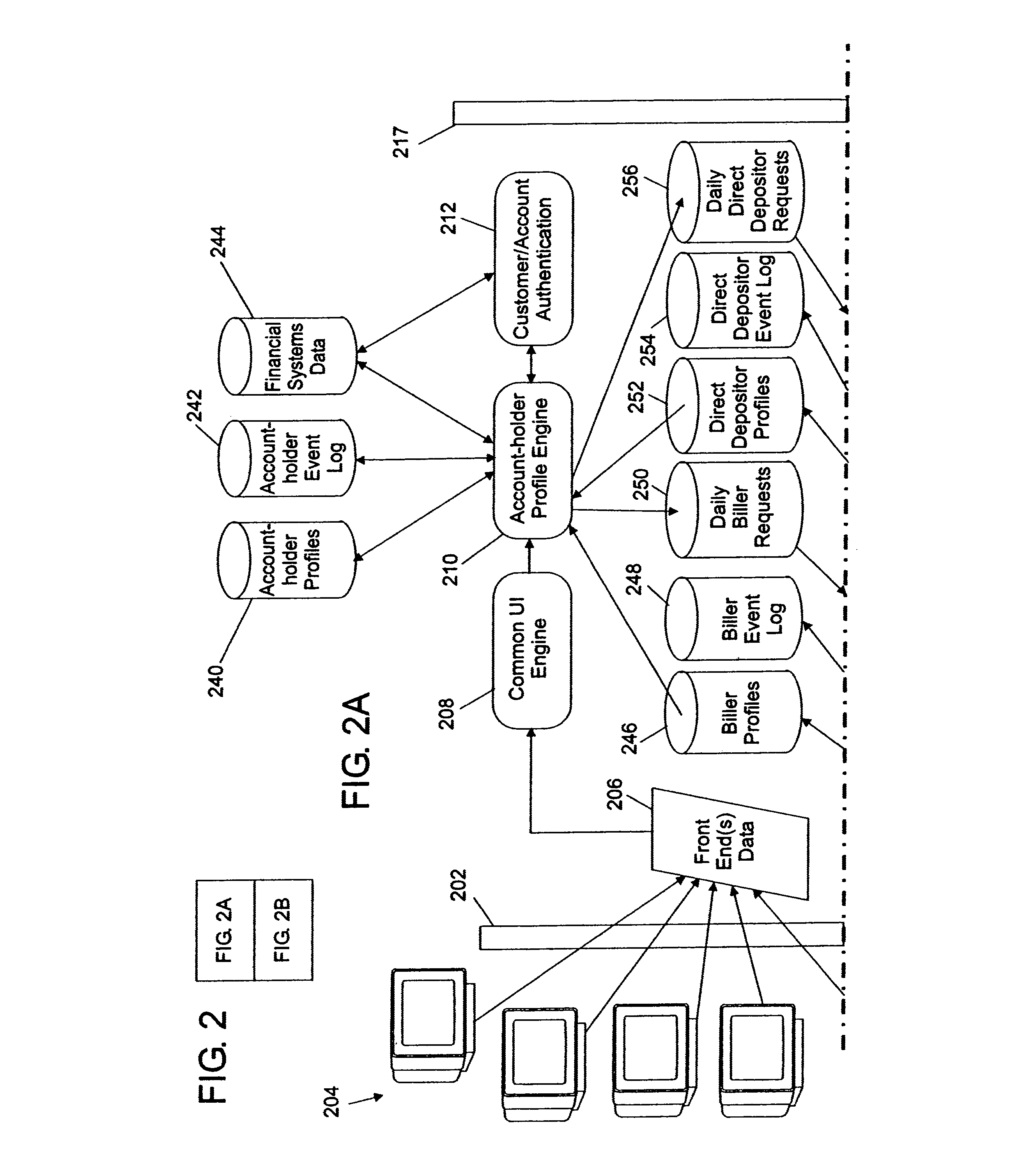

System and method for authorizing third-party transactions for an account at a financial institution on behalf of the account holder

System and method for authorizing third-party transactions for an account at a financial institution on behalf of the account holder. A financial institution can collect process, transmit and confirm authorizations to third parties for electronic payments and direct deposits on behalf of its account-holder customer. In at least some embodiments, a method of processing account-holder requests to authorize third-party transactions for an account includes the establishment of a pre-existing list of prospective third-party participants such as employers and billers. The financial institution receives account-holder requests to authorize third-party transactions. Specific requests from among the account-holder requests are matched to third-party participants and forwarded and can be confirmed. The system of the invention can include various engines and data repositories that work together to provide the means for implementing embodiments of the invention.

Owner:BANK OF AMERICA CORP

Methods, devices and bank computers for consumers using communicators to wire funds to sellers and vending machines

Owner:XYLON LLC

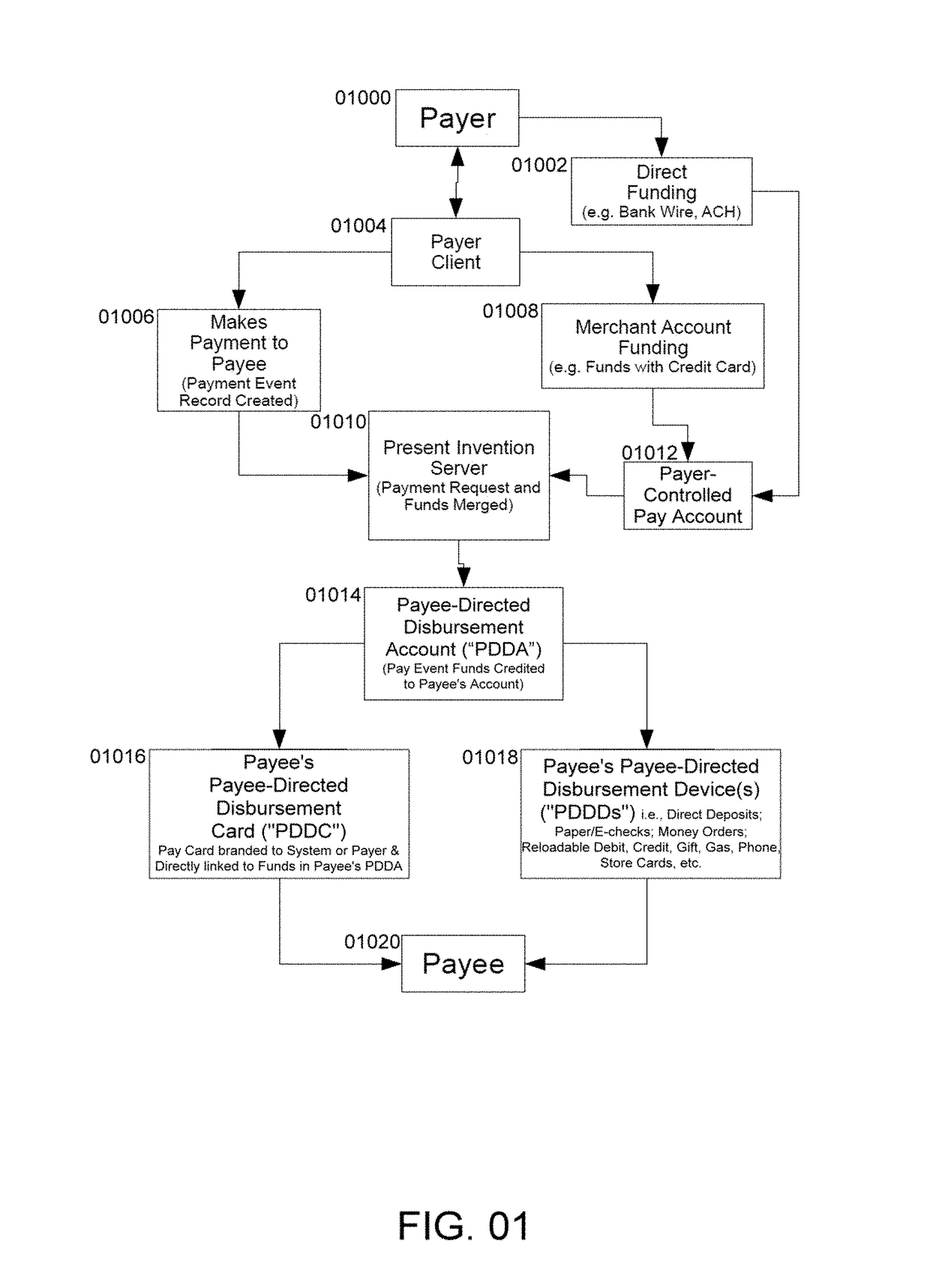

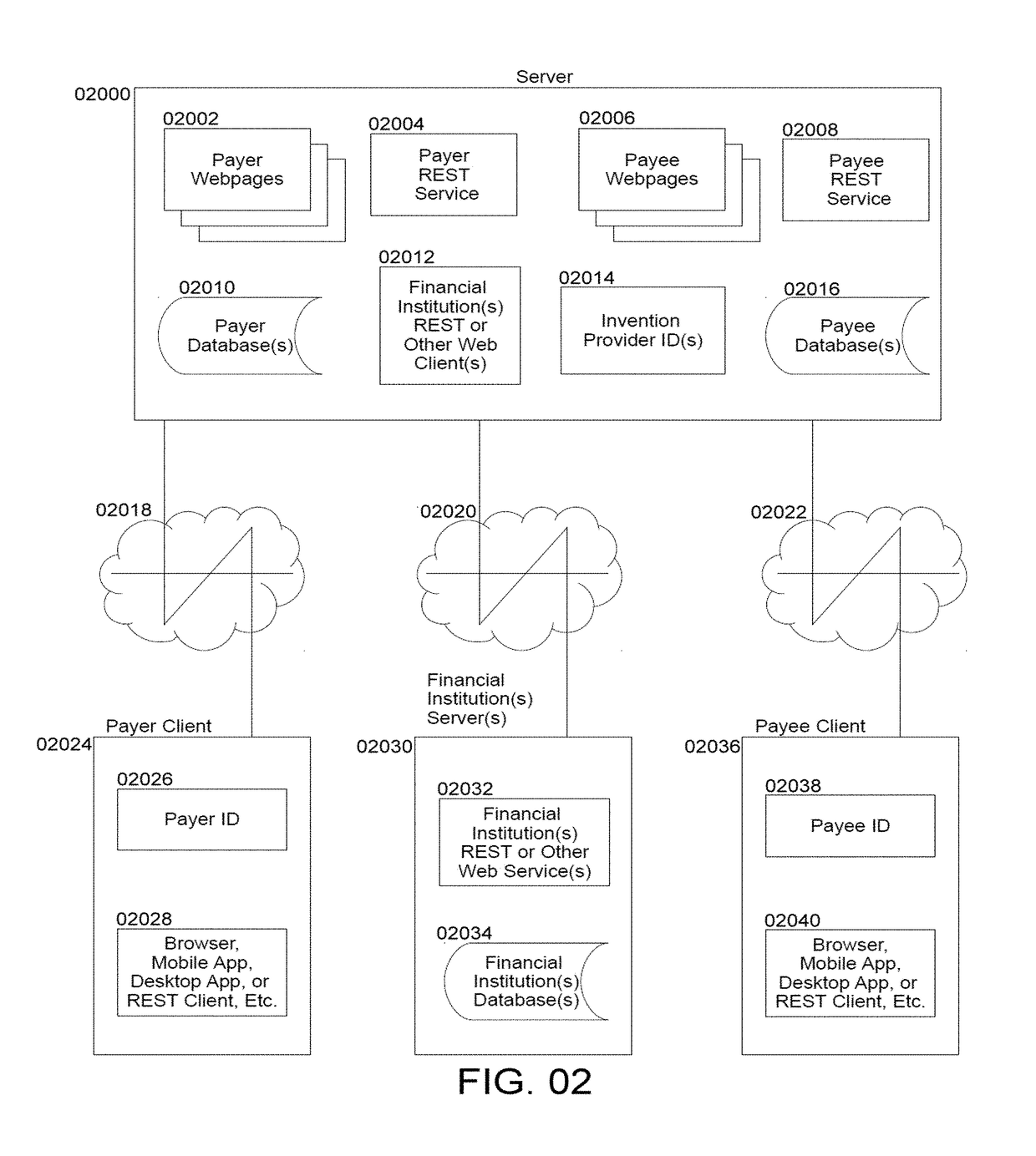

Private Payee-Controlled Compensation Disbursement System to Multiple Payee Directed Disbursement Devices

InactiveUS20170178110A1Simplify the fulfillment of their Payment Event obligationsExpand accessPayment schemes/modelsProtocol authorisationClient server systemsTelephone card

Present Invention enables non-cash-paid workers / vendors to rapidly receive net or gross compensation for rendered services / products with or without personal access to banking—unlimited by time and volume restrictions currently imposed by private label pay cards and systems. Present invention is a method, via a client server system, by which a Compensation Payer can issue individual or bulk funds to a secure Payer account—accompanied by (a) payment manifest(s)—which automatically and verifiably distributes to Payee-controlled accounts from which Payees can privately direct some or all of the received compensation to multiple Payee-Directed Disbursement Devices, including, without exclusion of others, direct deposit, paper / e-checks, money orders, and virtually any kind, number, and combination of verifiably legitimate debit, credit, gas, phone, gift, or store cards, prioritized, among others, by card, card type, and dollar amounts at Payee's directions received prior to or anytime after a specific payout disbursement.

Owner:SWANSON DAVID BENJAMIN +2

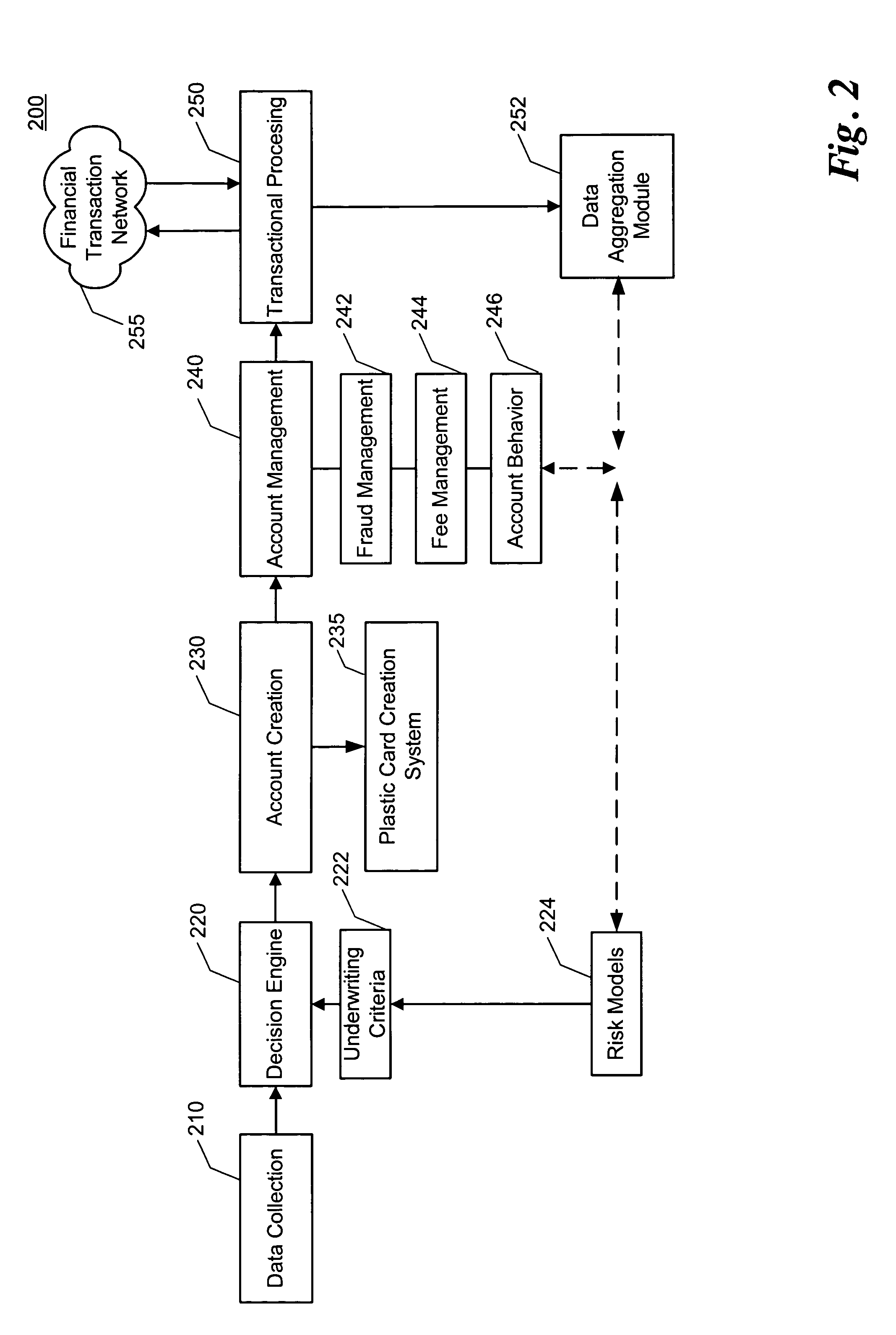

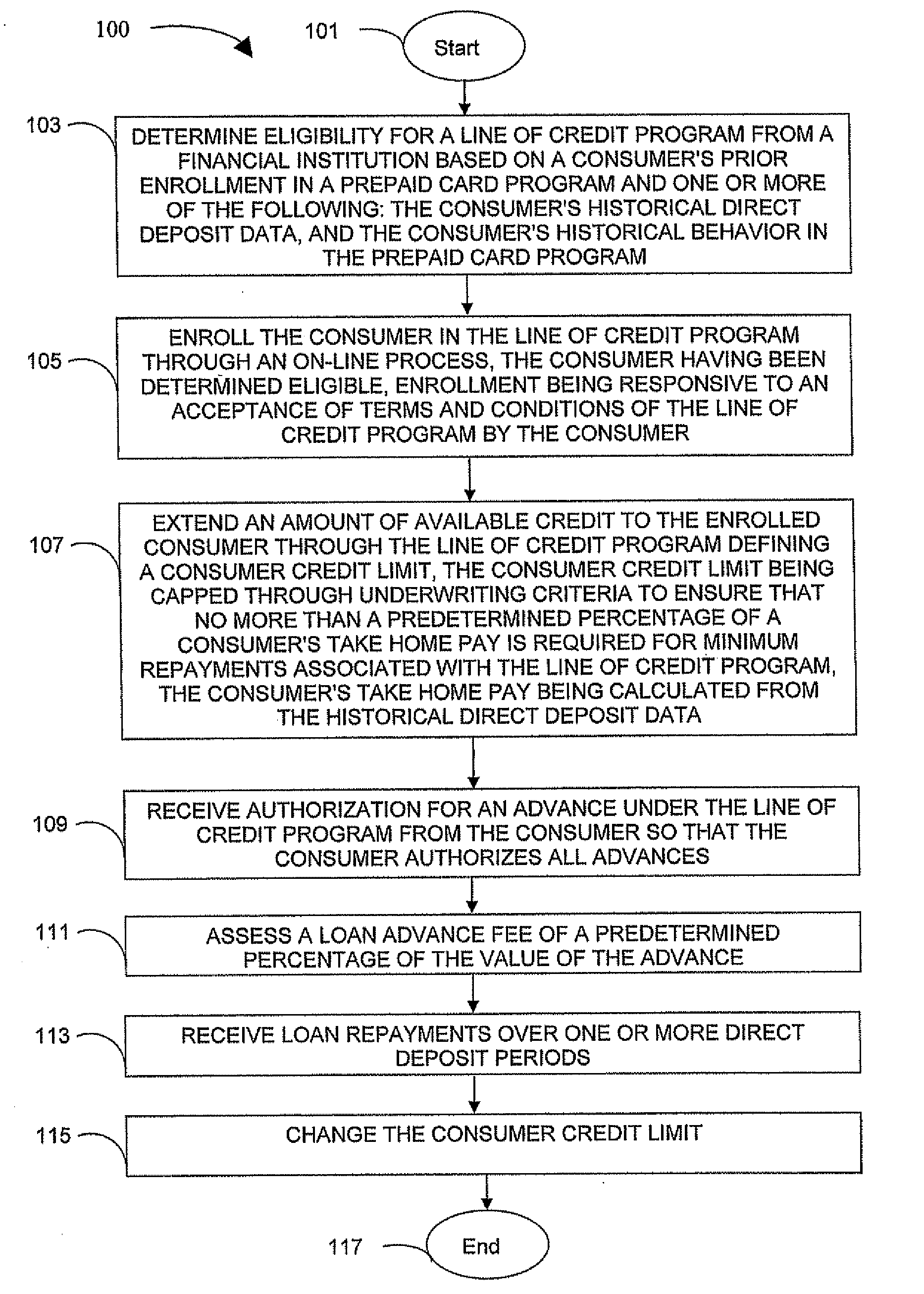

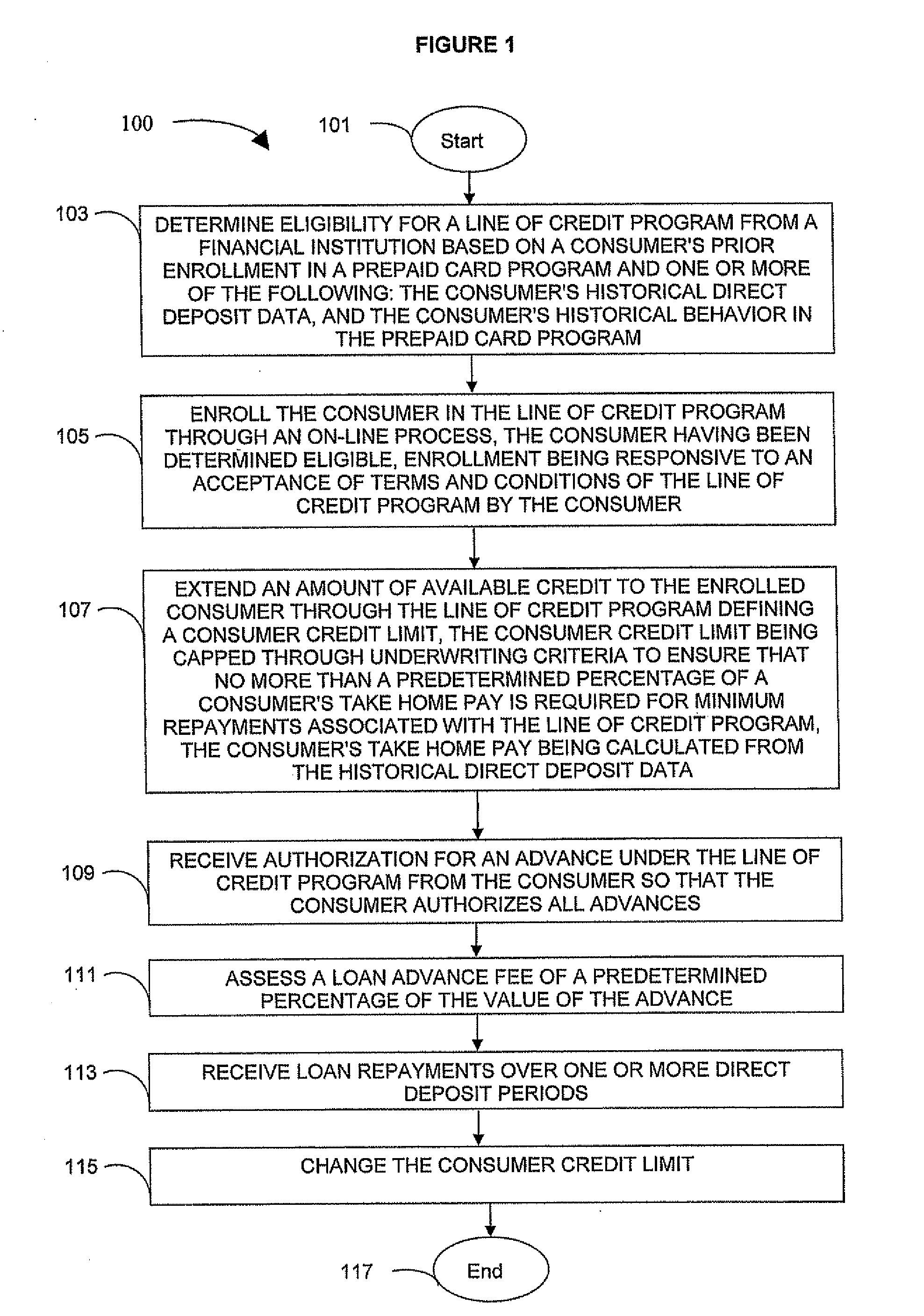

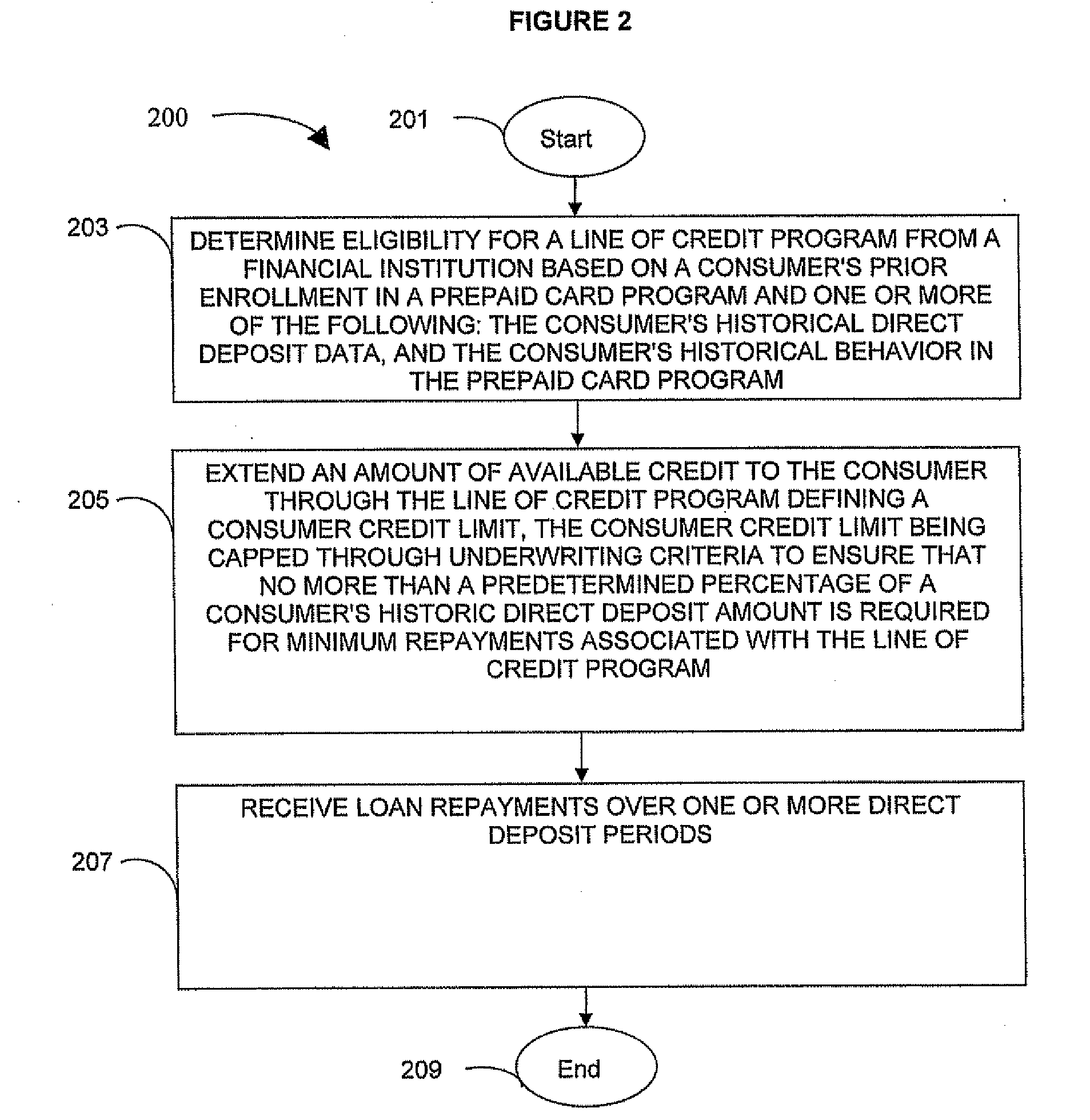

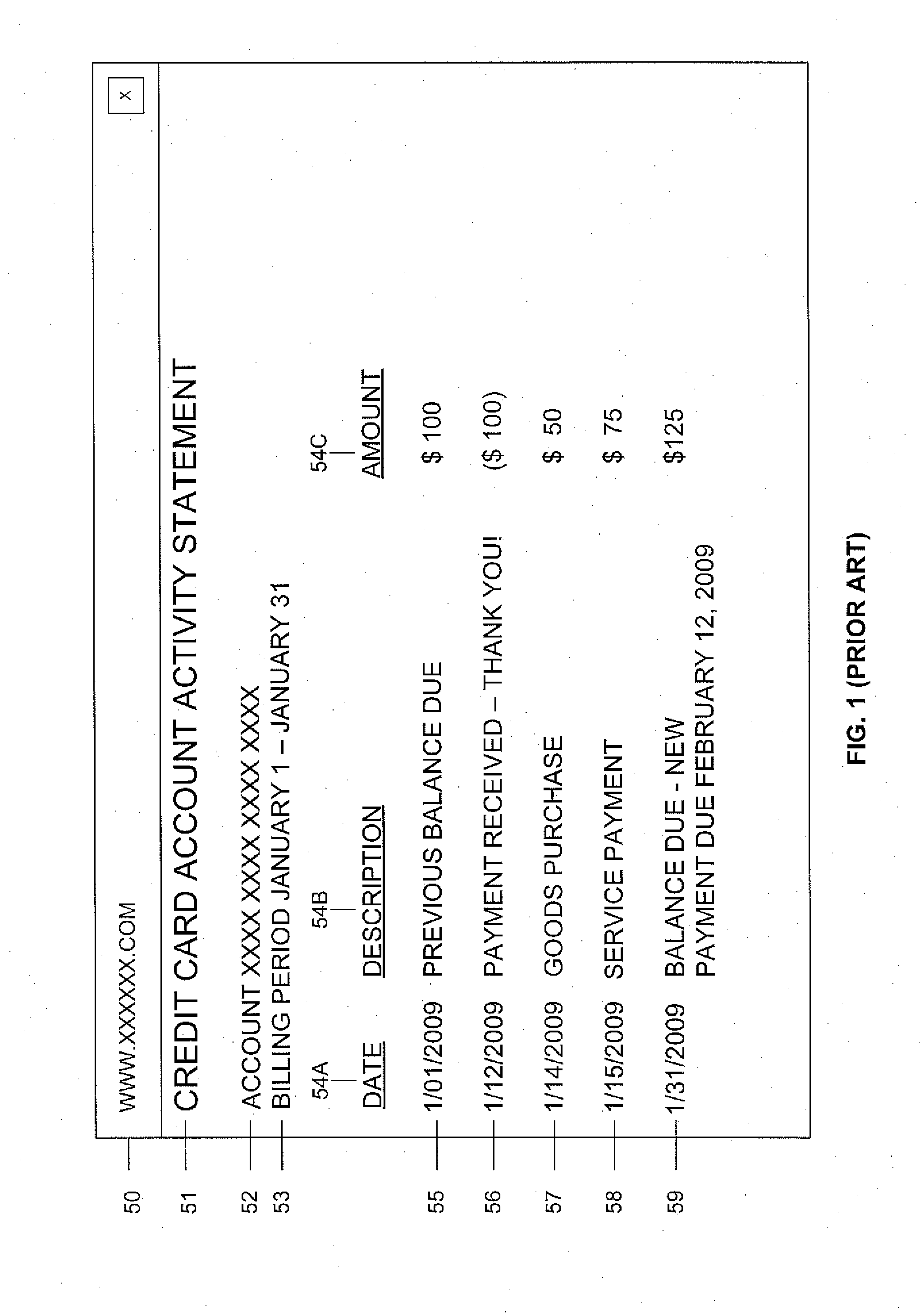

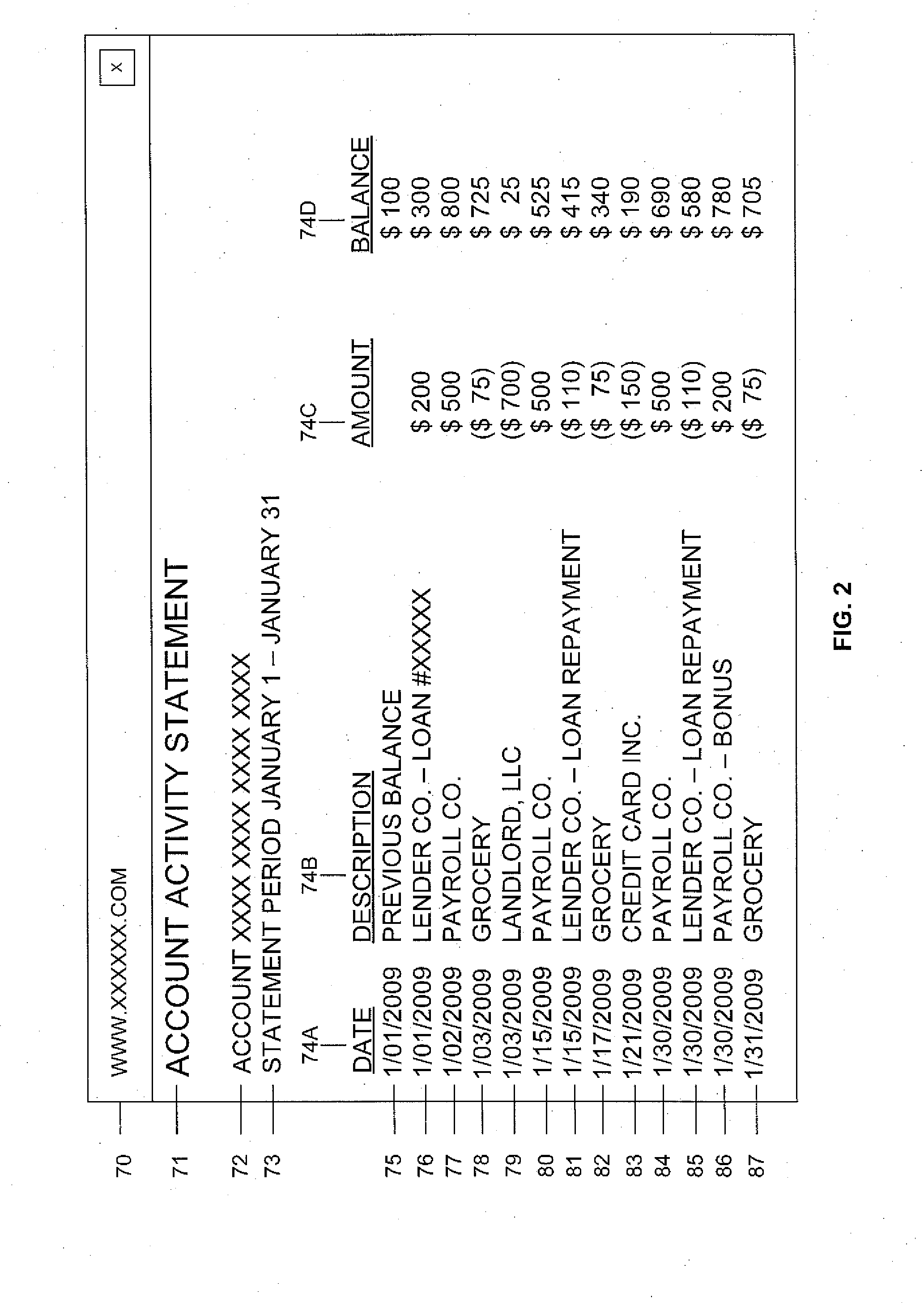

Computer-Implemented Methods, Program Product, And System To Enhance Banking Terms Over Time

ActiveUS20090164364A1Easy to optimizeGood serviceFinancePoint-of-sale network systemsProgram planningCredit limit

Managing access to a line of credit, for example, can include a financial institution computer determining eligibility for a line of credit program responsive to a consumer's prior enrollment in a prepaid card program and one or more of the following: the consumer's historical direct deposit data, and data associated with the consumer's historical behavior in the prepaid card program. The financial institution computer can extend an amount of available credit to the consumer through the line of credit program so that a consumer credit limit is capped through underwriting criteria to ensure that no more than a predetermined percentage of a consumer's historic direct deposit amount is required for minimum repayments. The financial institution computer can farther receive loan repayments over one or more predetermined direct deposit periods and change the consumer credit limit by preselected increments responsive to a change in the consumer's direct deposit amount.

Owner:PATHWARD NAT ASSOC

System and method for effecting payment for an electronic auction commerce transaction

Owner:XPRT VENTURES

Titanium dioxide perforated micro-pipe photocatalyst modified by silver and its prodn. method

InactiveCN101015792AHigh catalytic activityImprove degradation rateMetal/metal-oxides/metal-hydroxide catalystsPhotocatalytic reactionChloride

The invention relates to a titania porous micro tube optical catalyst modified by silver for degrading fenol in water and relative preparation. The inventive catalyst is TiO2 porous micro tube modified by silver with specific structure composed from direct deposit method, that using titanic chloride as titanium source, directly hydrolyzing and depositing, in the condition with some dispersers, to be filtered, washed, dried, baked and activated to obtain final TiO2 optical catalyst modified by silver. The inventive catalyst has specific structure, integral appearance, and uniform aperture, thereby improving the ability for degrading fenol, with high activity in optical catalysis, the ability for degrading fenol into water and carbon dioxide, and wide application.

Owner:FUDAN UNIV

Computer-Implemented Methods, Computer Program Products, and Systems for Enhanced Loan Product Repayments

InactiveUS20120109820A1Enhanced lending optionA large amountFinancePayment architectureProgram planningComputer science

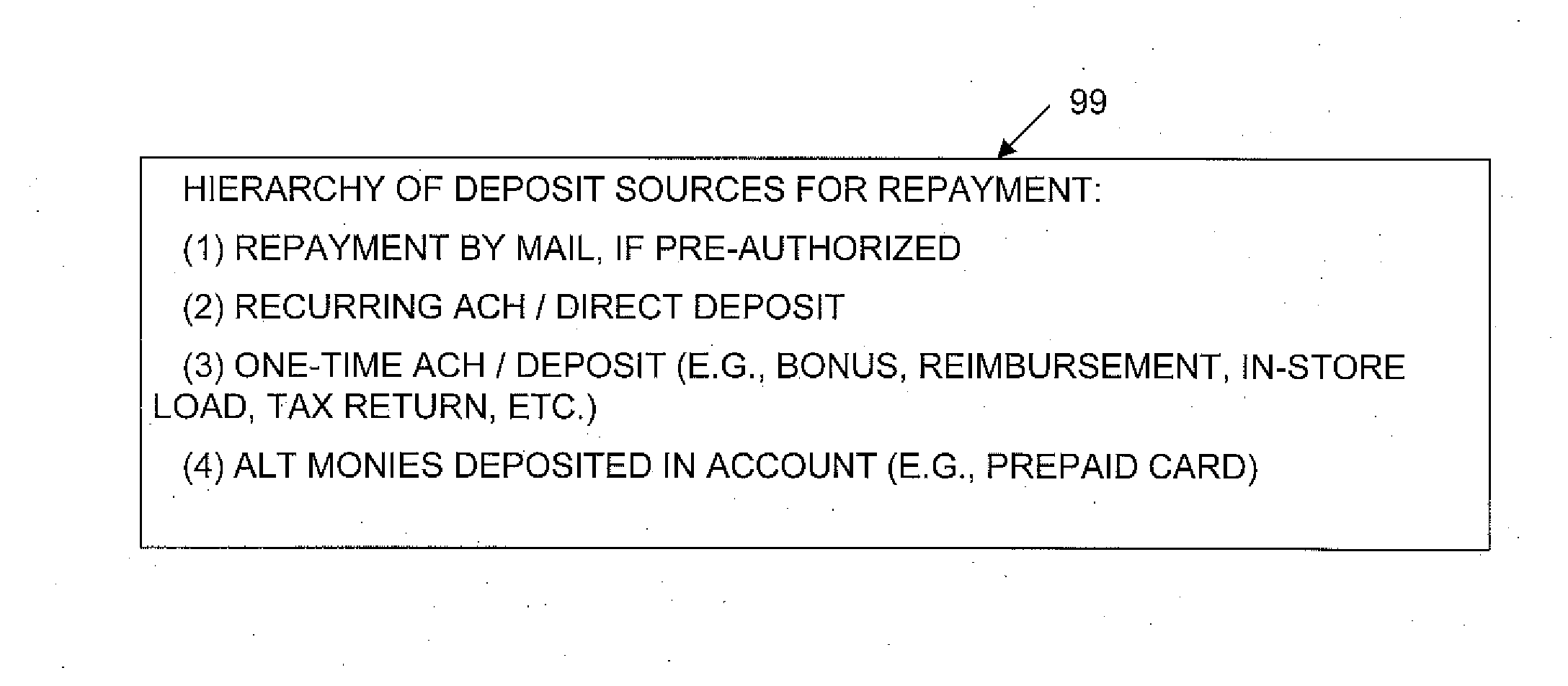

A computer configured and programmed as a financial institution computer, method, and system to schedule and obtain loan repayments from a customer, including flexible loan repayment mechanisms and schedules corresponding to expected deposit dates, e.g., multiple paydays. The computer can determine a repayment schedule for one or more loans responsive to an electronic loan request by the customer, direct deposit data for the customer, and preselected loan product parameters. The computer can monitor an account for an expected direct deposit from a first time prior to an expectation date of the expected direct deposit and up to a second time after the expectation date for the expected direct deposit to thereby define a time period around the expected direct deposit. The computer can obtain one or more repayments responsive to a receipt of the expected direct deposit, the expected direct deposit being one of a predetermined hierarchy of deposit sources.

Owner:METABANK

Virtual piggybank having dashboard and debit card

A computer-implemented method of establishing an online account for a prospective user, the method comprising the steps of establishing a first account through direct deposit, the settings of the first account being stored in a database; establishing a second account, the settings of the second account being stored in the database, wherein the second account includes a debit card associated with the direct deposit account; linking the first and second accounts such that control settings of the second account are determined through the first account; and making a purchase from the second account using the debit card consistent with the control settings of the second account.

Owner:VIRTUAL PIGGY

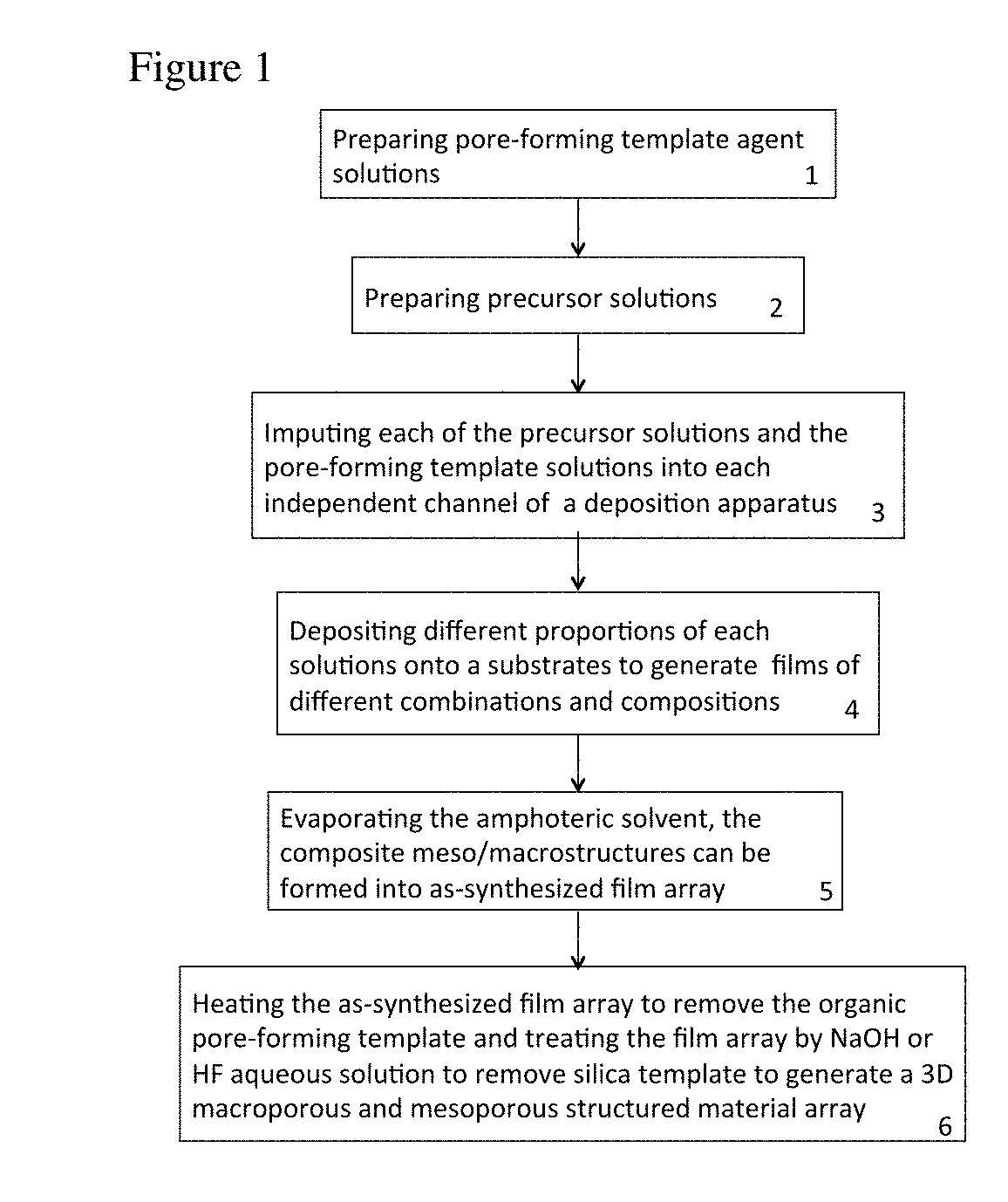

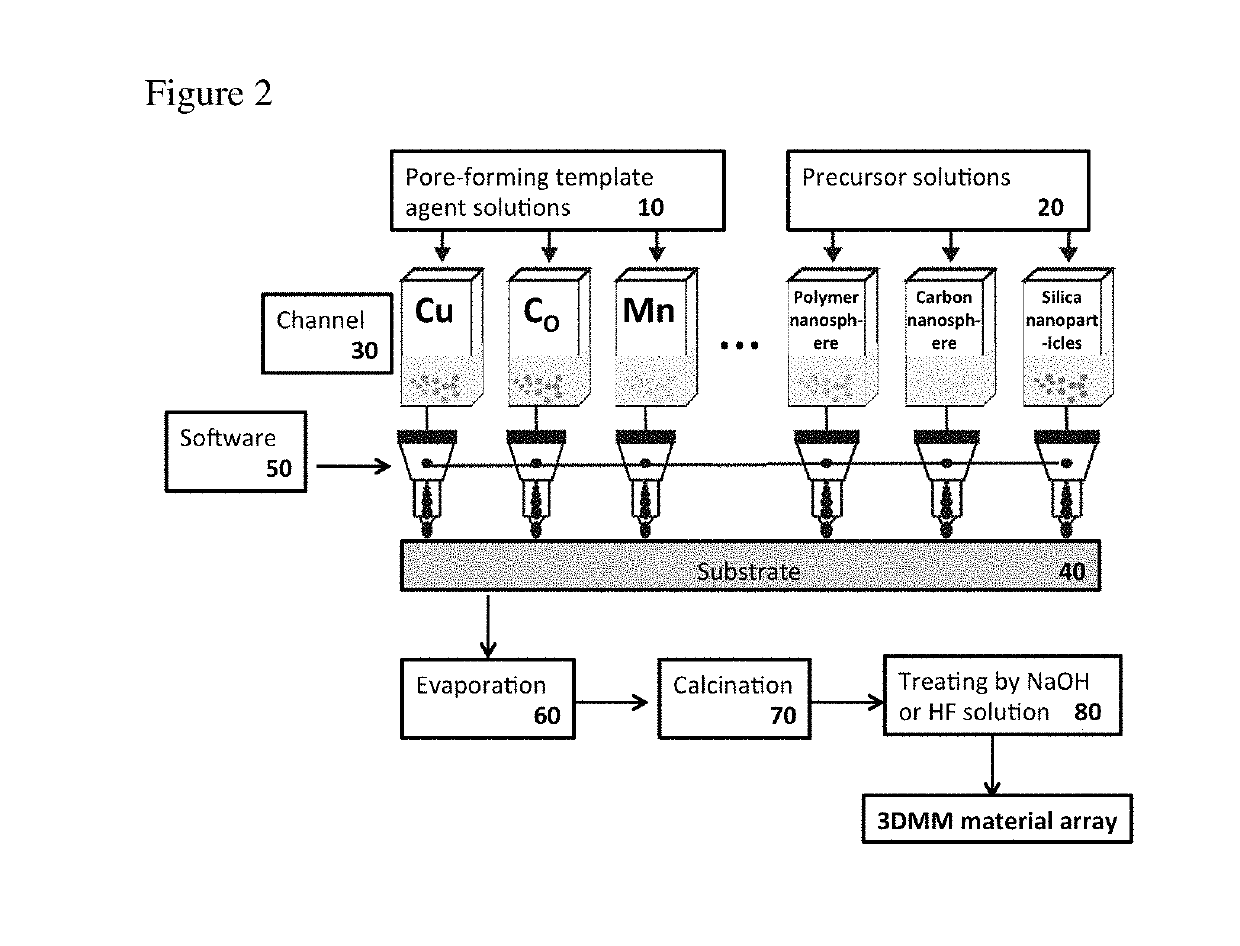

Multi-channel direct-deposit assembly method to high-throughput synthesize three-dimensional macroporous/mesoporous material array

ActiveUS20190336932A1Quick compositionMaterial nanotechnologySequential/parallel process reactionsMesoporous materialDirect deposit

A multi-channel direct-deposit assembly method is disclosed to high-throughput synthesize three-dimensional macroporous / mesoporous (3DMM) material array with precisely controlled composition, pore size, and pore structure. The macropore size of the synthesized 3DMM material is in the range of 50-1000 nm; the mesopore size of the synthesized 3DMM material is in the range of 1-50 nm. The surface area of the 3DMM material is in the range of 20-1000 m2 / g. The 3DMM material array can be used for rapid synthesis, screening and manufacture of catalysts and nanosensors.

Owner:TAO TREASURES LLC

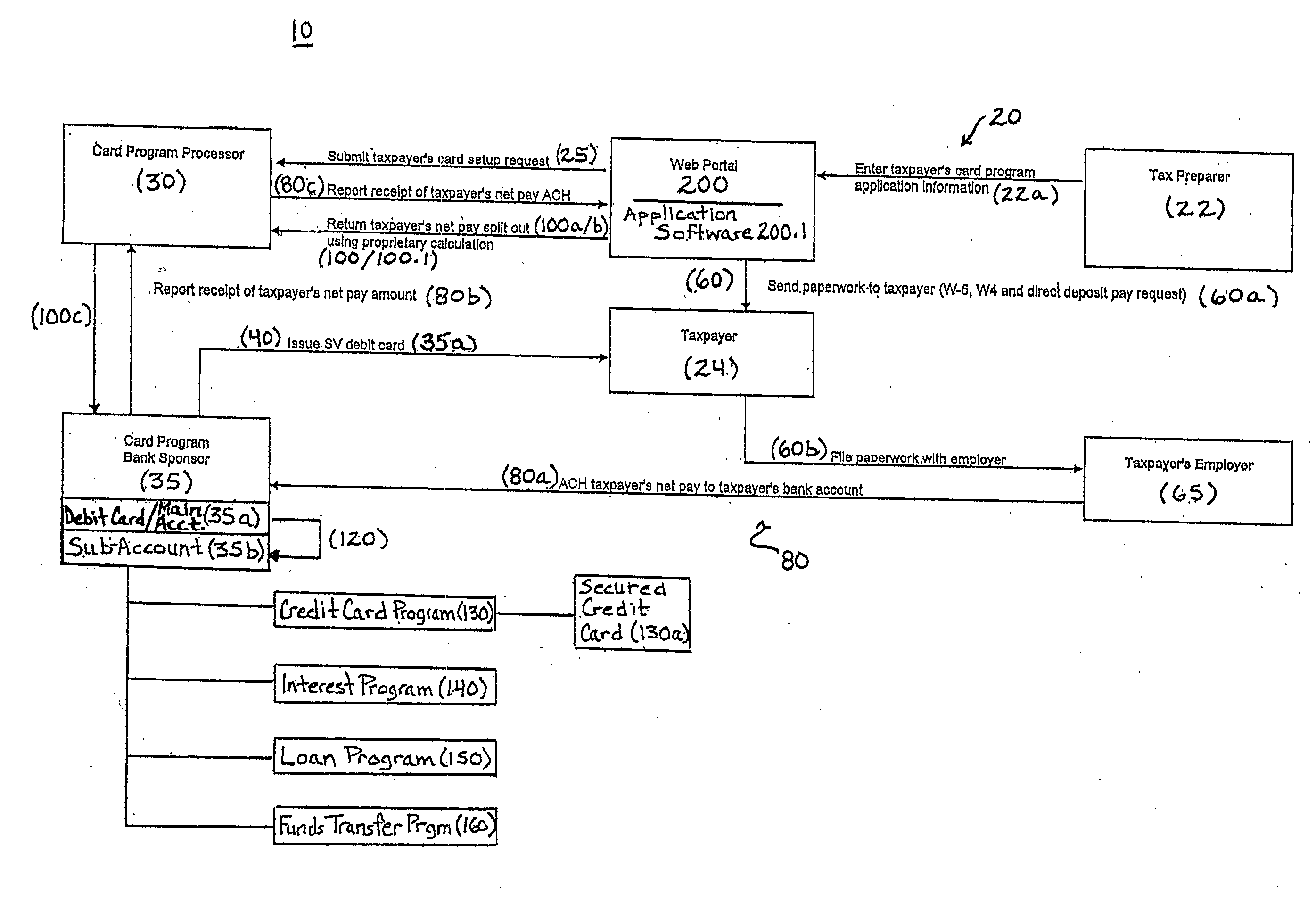

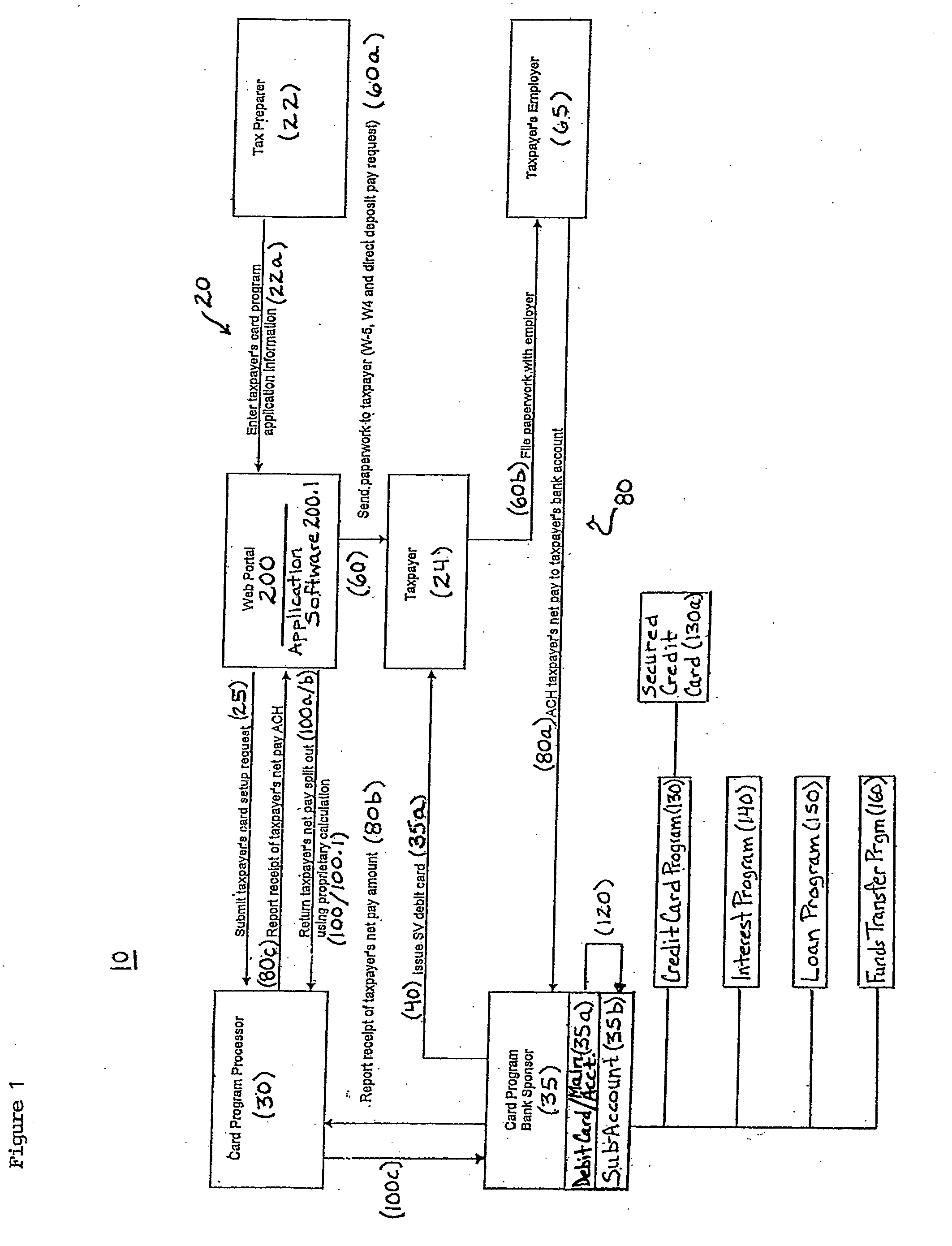

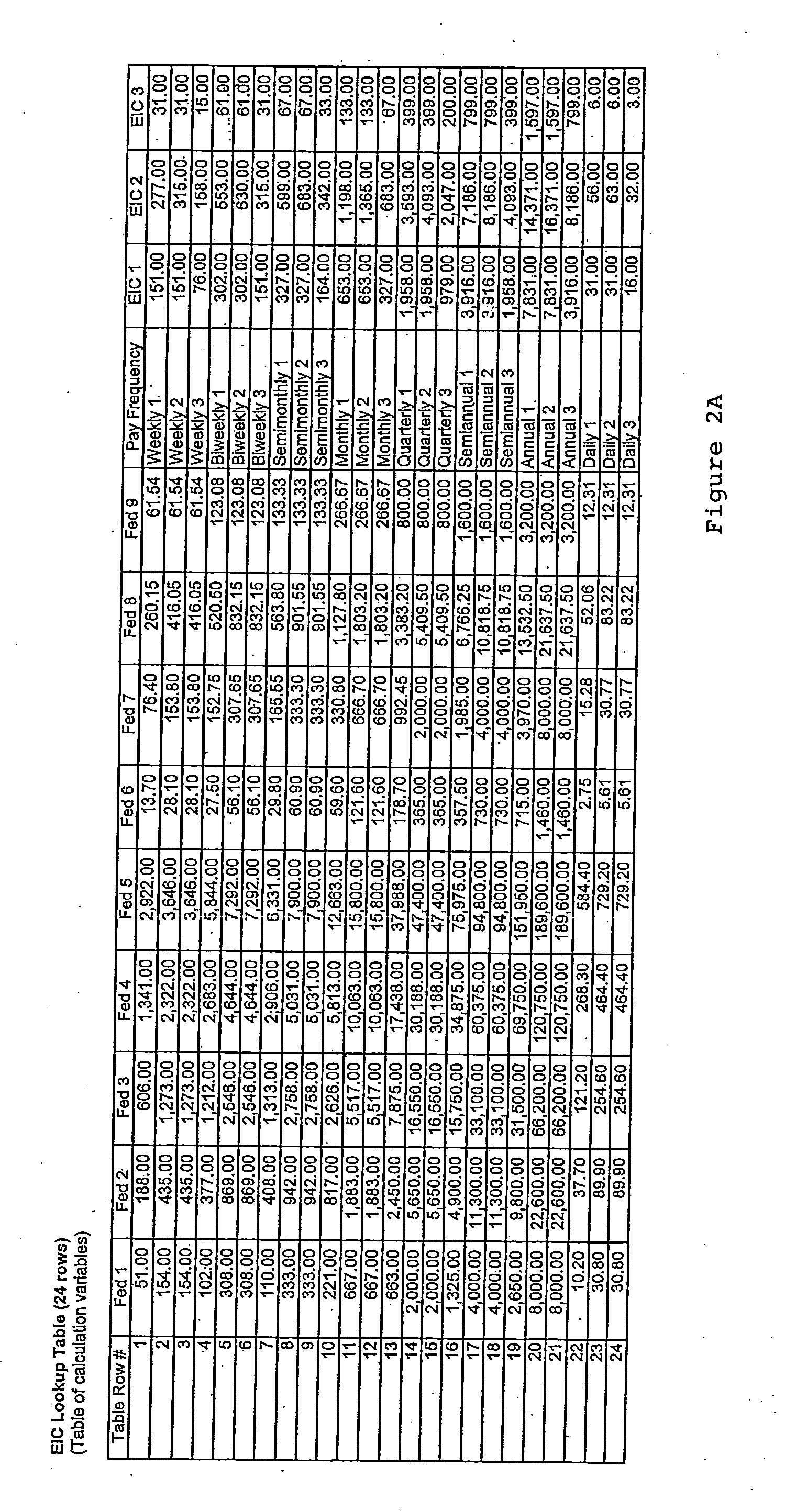

System and method for financial management of advance earned income credit

InactiveUS20070168274A1Encourages fiscal responsibilityEasy extractionFinanceBank accountDirect deposit

A system and method for financial management of advance earned income credit, wherein eligible taxpayers may elect direct deposit of their paychecks (i.e., net pay), advance earned income credit (advance EIC) inclusive, onto a stored-value debit card that functions as a main bank account. Thereafter, the advance EIC portion of the taxpayer's net pay may be automatically extracted from the net pay direct deposited onto the debit card and conveniently transferred into an associated sub-account (also referred to as a savings pocket or purse). Through the present debit card and associated sub-account program, and the accumulated advance EIC payments thereof, taxpayers may qualify to receive various benefits, including, without limitation, interest accumulation on sub-account balances, credit card issuance with overdraft protection, loan eligibility, and credit history development.

Owner:TAYLOR ROBERT H

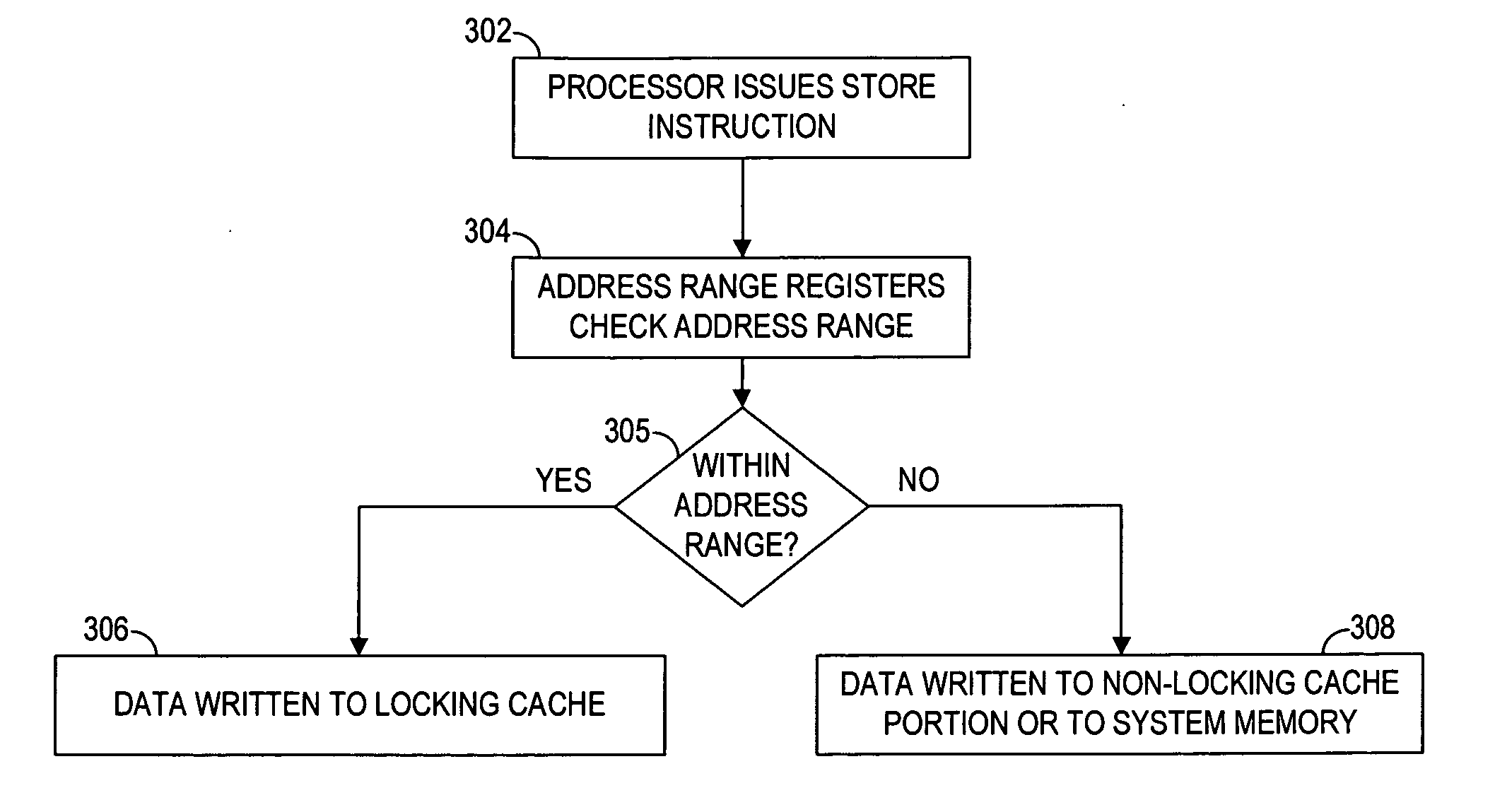

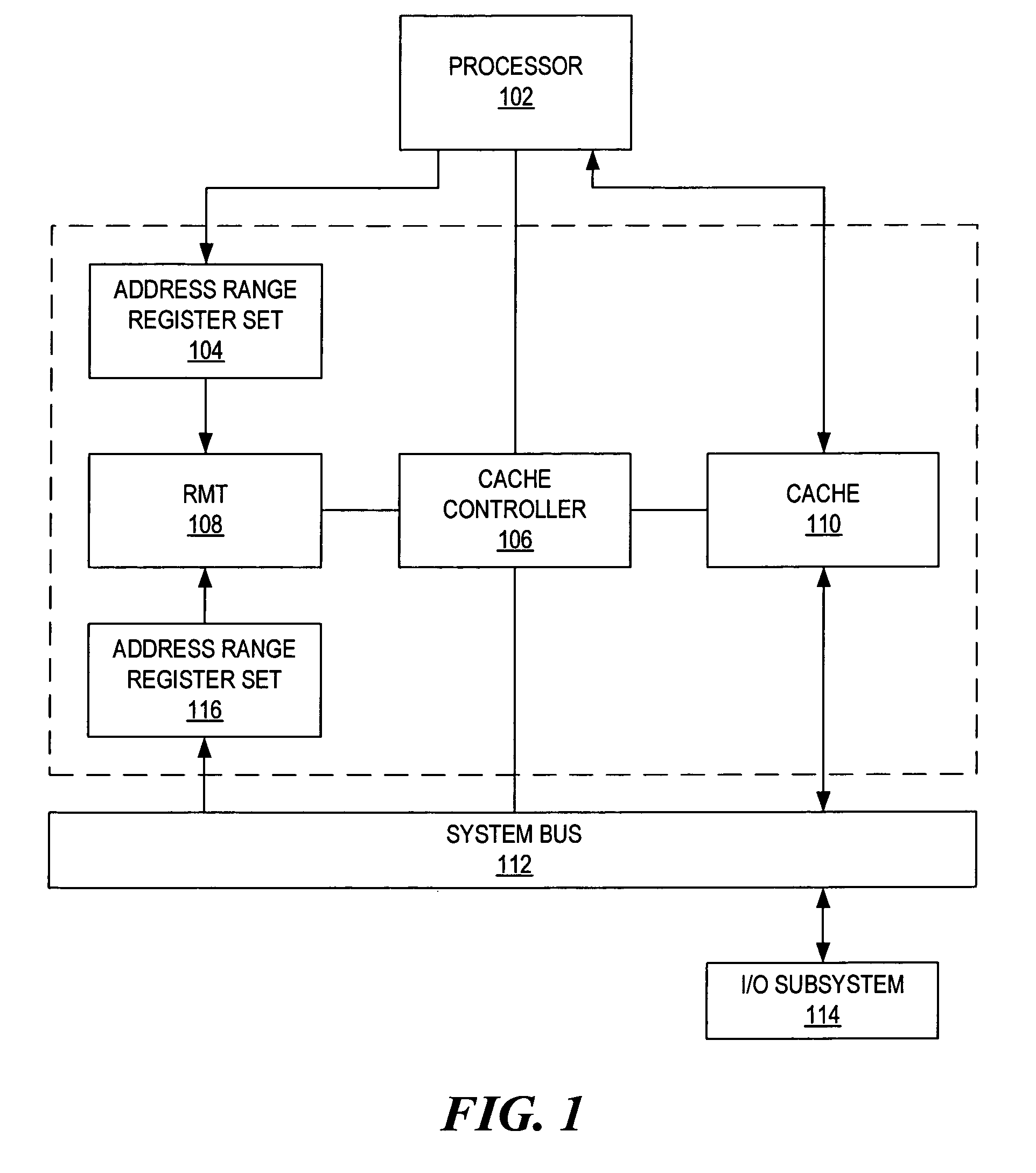

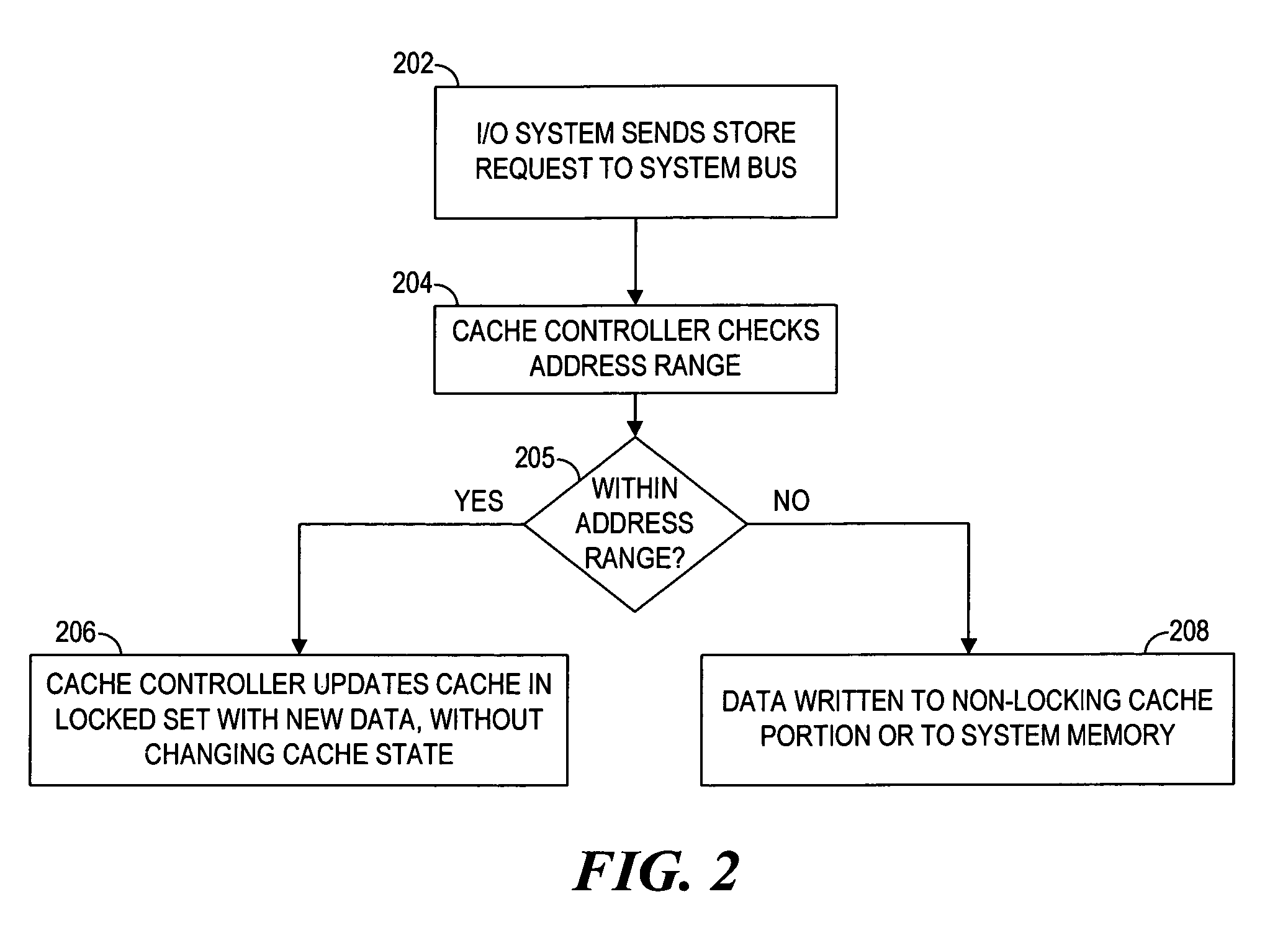

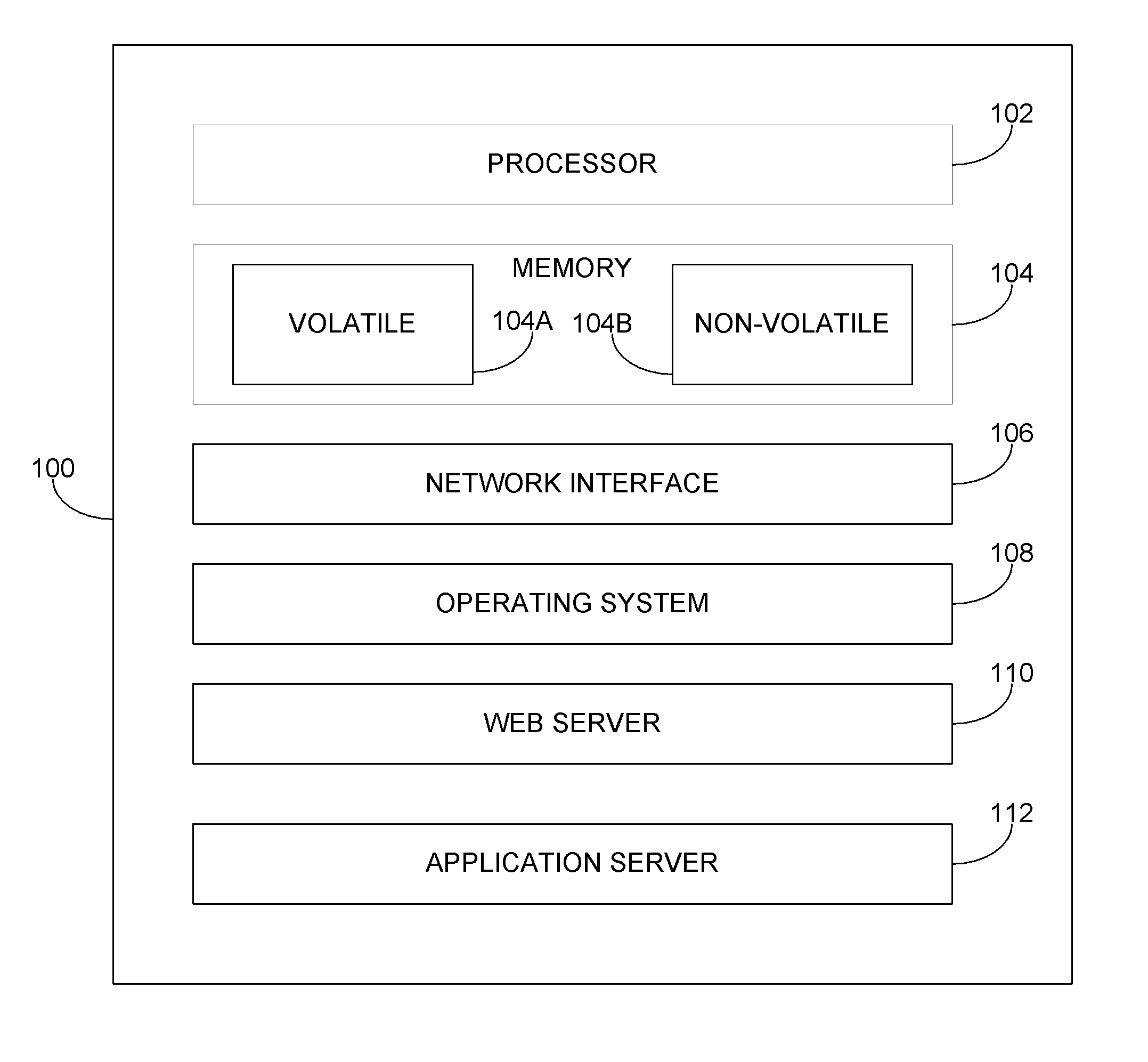

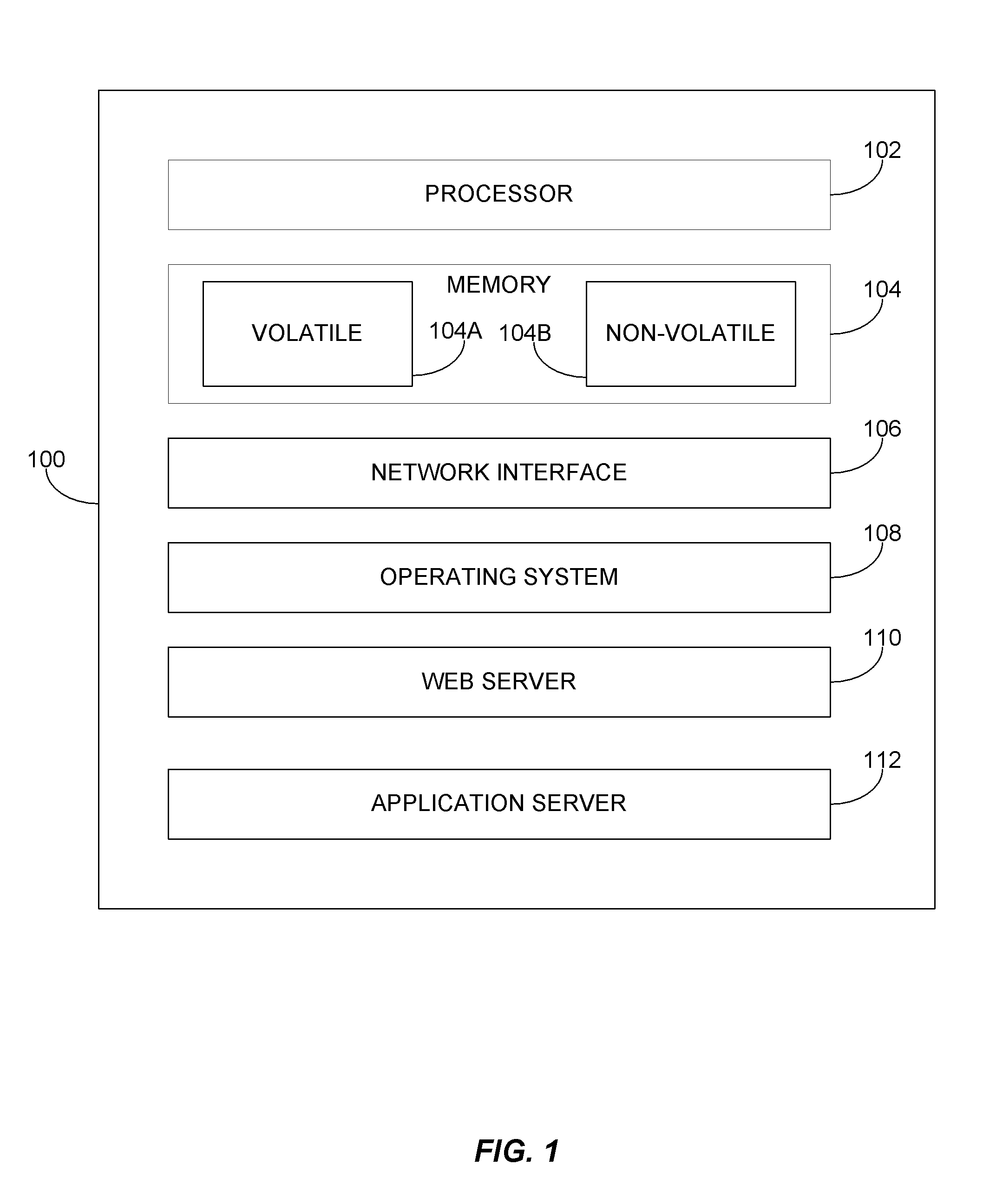

Direct deposit using locking cache

The present invention provides a method of storing data transferred from an I / O device, a network, or a disk into a portion of a cache or other fast memory, without also writing it to main memory. Further, the data is “locked” into the cache or other fast memory until it is loaded for use. Data remains in the locking cache until it is specifically overwritten under software control. In an embodiment of the invention, a processor can write data to the cache or other fast memory without also writing it to main memory. The portion of the cache or other fast memory can be used as additional system memory.

Owner:IBM CORP

System and method for guarding against fraudulent direct deposit enrollments in an issuer-effectuated enrollment system

Systems and methods disclosed herein provide improved security against fraudulent direct deposit enrollments in an issuer-effectuated direct deposit enrollment system. By providing visibility across multiple account products and issuers, the system is able to detect fraudulent enrollments and create negative lists that may be shared among, and utilized by, multiple issuers.

Owner:TREFOIL TECH

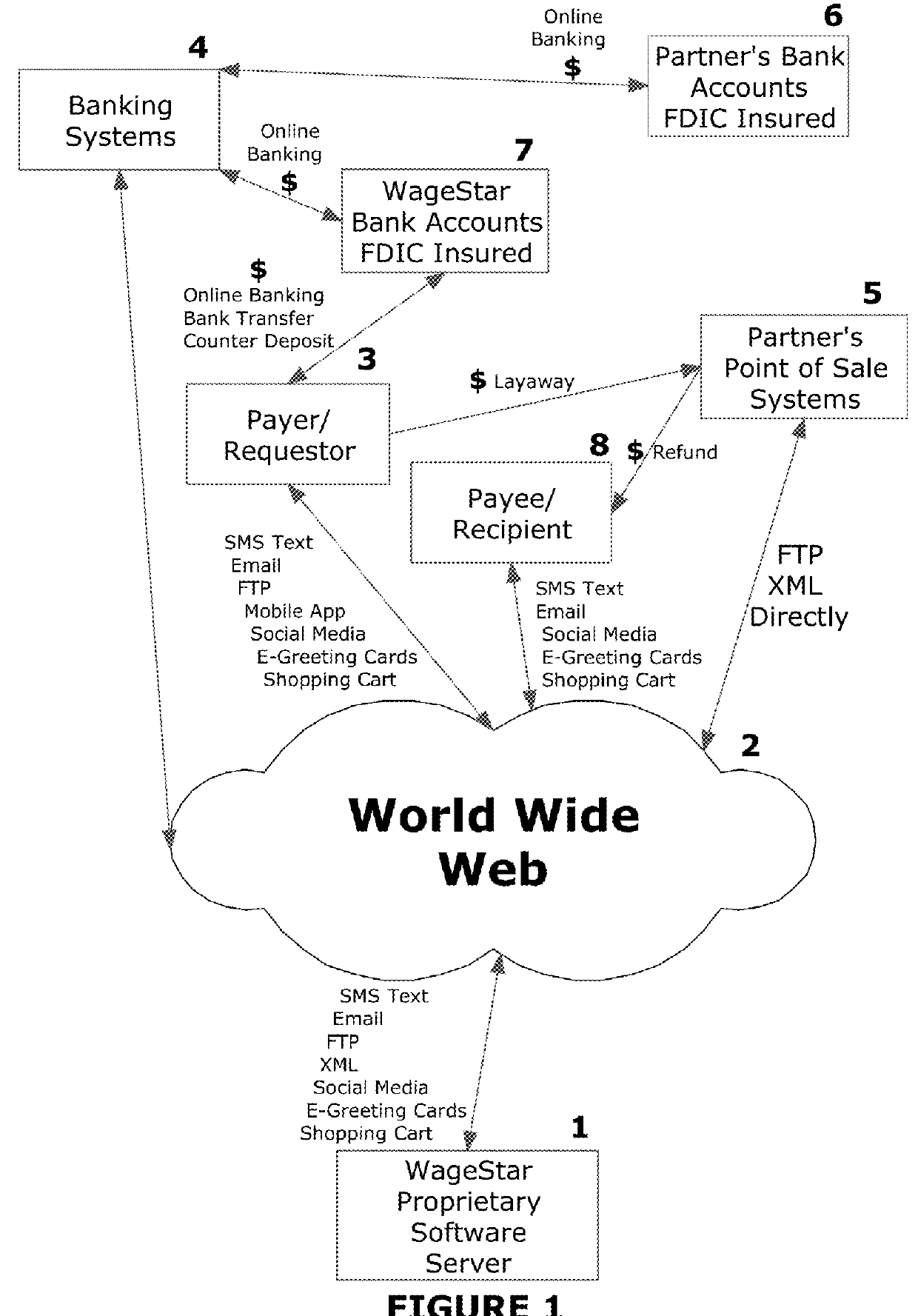

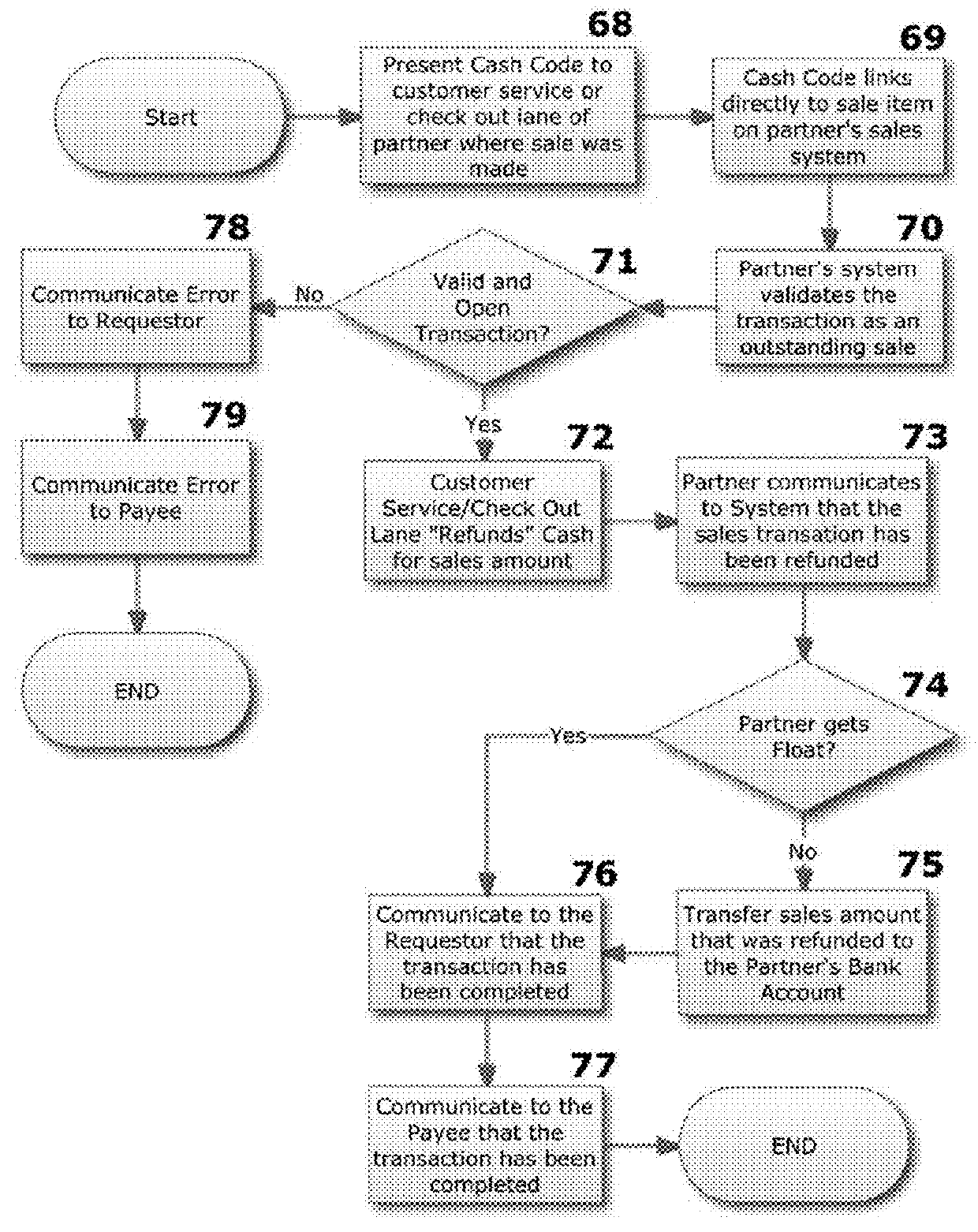

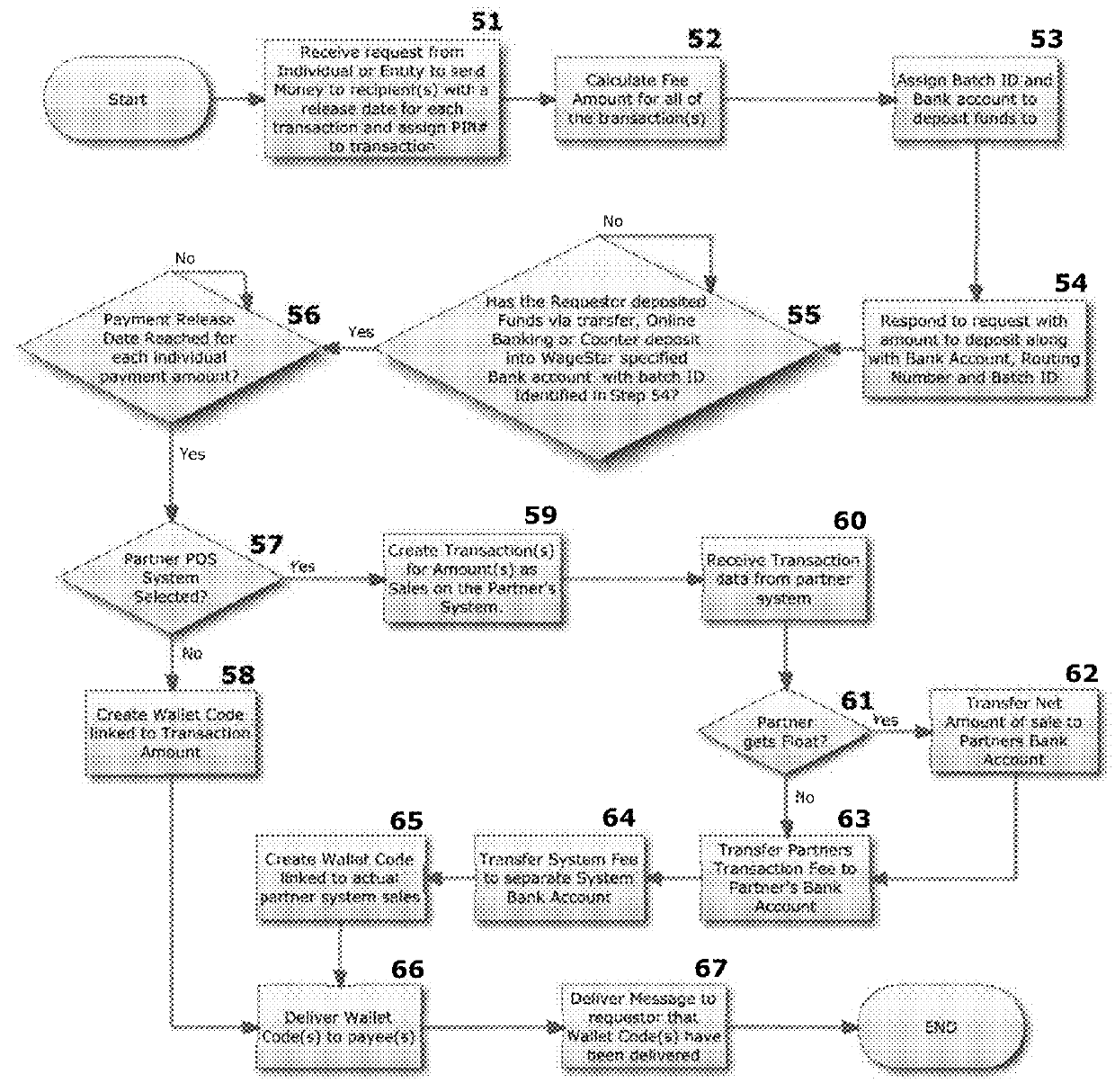

Method to disburse funds using retailer's point of sale system

InactiveUS20160034875A1Easy to integrateImprove usabilityPoint-of-sale network systemsProtocol authorisationBank accountSystem usage

A unique and novel method is disclosed whereby funds are made available in a secure fashion to people who do not have bank accounts but want the security of a direct deposit system. Employers receive the benefit of the reduction in paperwork and increase in safety, and the employee receives also safety in obtaining funds at greatly reduced costs and fees to the employee. This system uniquely operates using the return or refund portion of a retailers POS system at the cash register or through their customer service desk. This method also works with people wanting to transfer funds to others in a safe manner with reduced fees. This unique method uses a single transaction process to reduce complicated back end systems hardware and architecture to calculate remaining balances. Vendors benefit from this system in that they are able to accomplish the number one goal of any retailer: getting the customers into their stores.

Owner:QR KASH

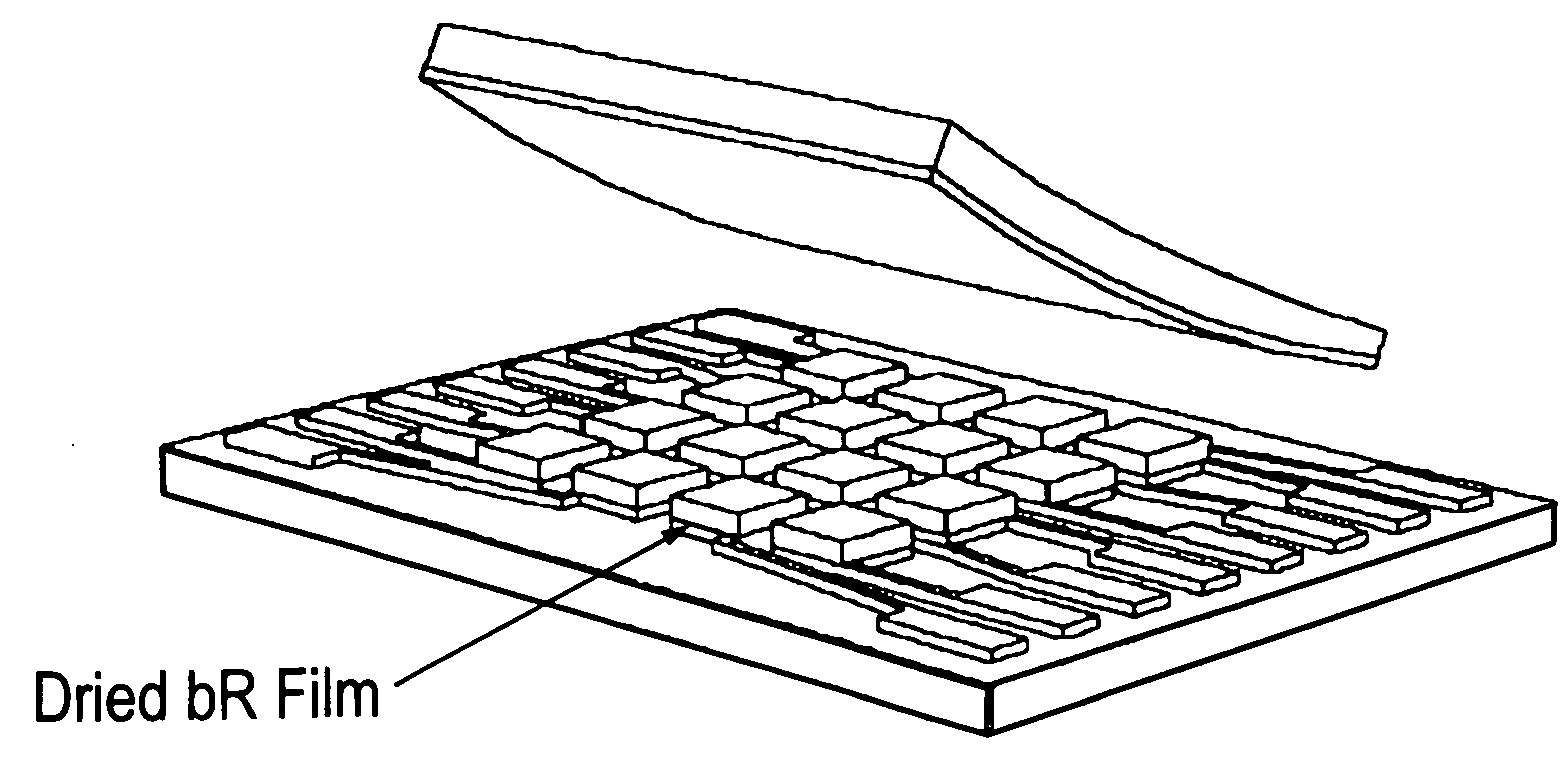

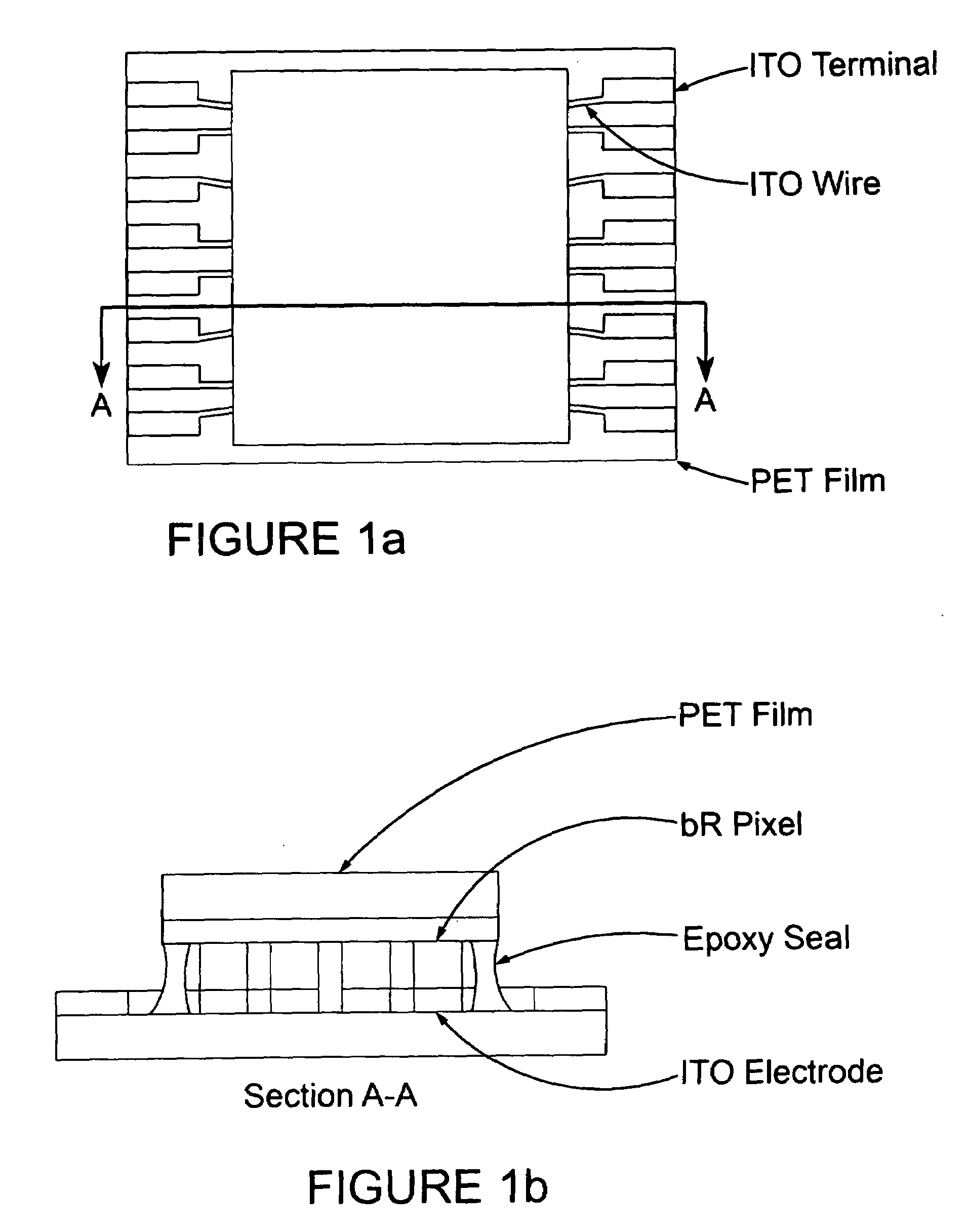

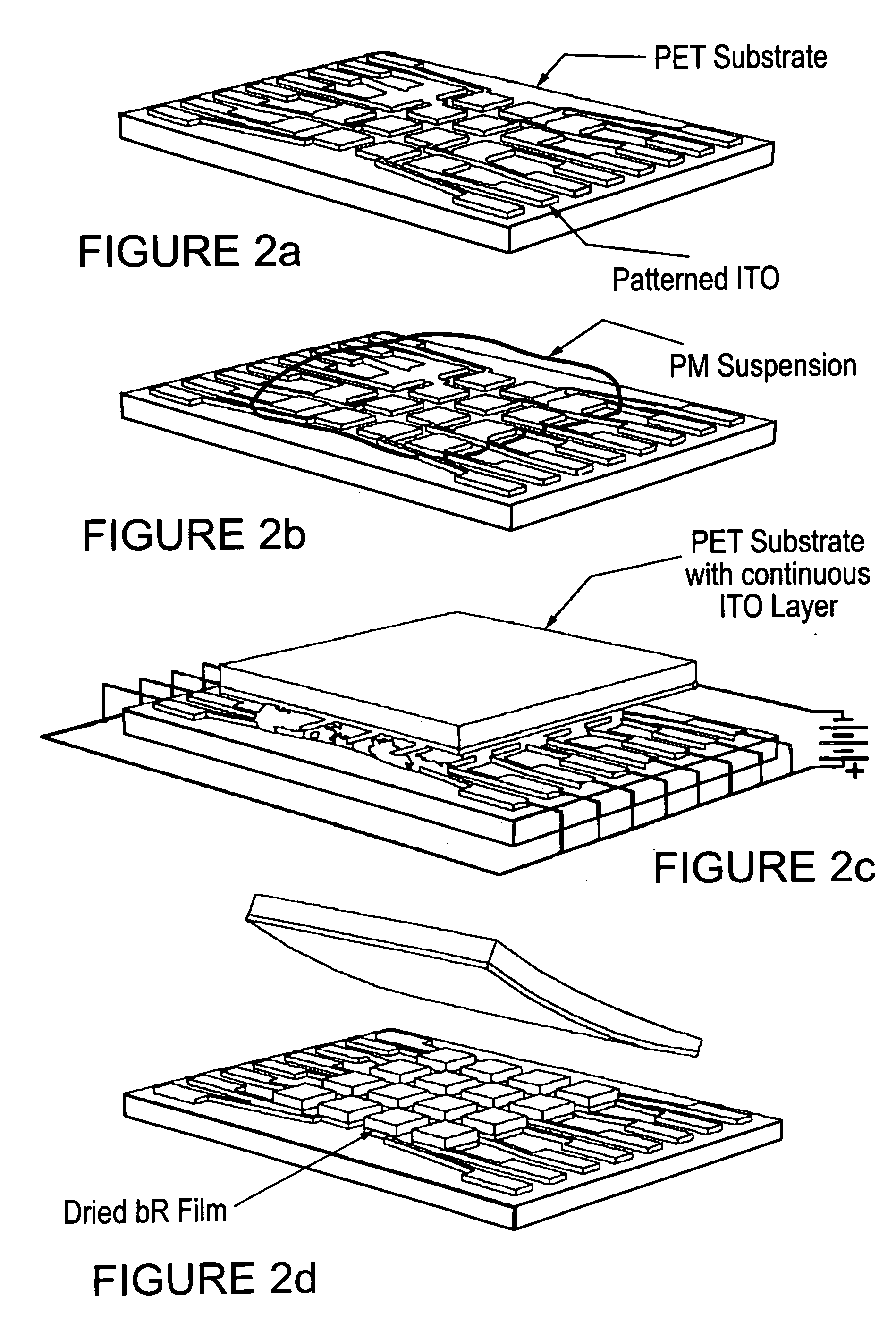

Flexible bioelectronic photodetector and imaging arrays based on bacteriorhodopsin (BR) thin films

The direct deposit of photoelectric materials onto low-cost prefabricated patterned flexible electrodes provided by the present invention introduces a new design approach that permits the development of innovative lightweight, durable and non-planar sensing systems. By extending single and multi-spectral bioelectronic sensing technology to flexible plastic substrates, the invention offers a number of potential advantages over structurally rigid silicon-based microelectronics (e.g. CMOS) including a reduction in spatial requirements, weight, electrical power consumption, heat loss, system complexity, and fabrication cost.

Owner:UNIV OF WESTERN ONTARIO

System and method for authorizing third-party transactions for an account at a financial institution on behalf of the account holder

System and method for authorizing third-party transactions for an account at a financial institution on behalf of the account holder. A financial institution can collect process, transmit and confirm authorizations to third parties for electronic payments and direct deposits on behalf of its account-holder customer. In at least some embodiments, a method of processing account-holder requests to authorize third-party transactions for an account includes the establishment of a pre-existing list of prospective third-party participants such as employers and billers. The financial institution receives account-holder requests to authorize third-party transactions. Specific requests from among the account-holder requests are matched to third-party participants and forwarded and can be confirmed. The system of the invention can include various engines and data repositories that work together to provide the means for implementing embodiments of the invention.

Owner:BANK OF AMERICA CORP

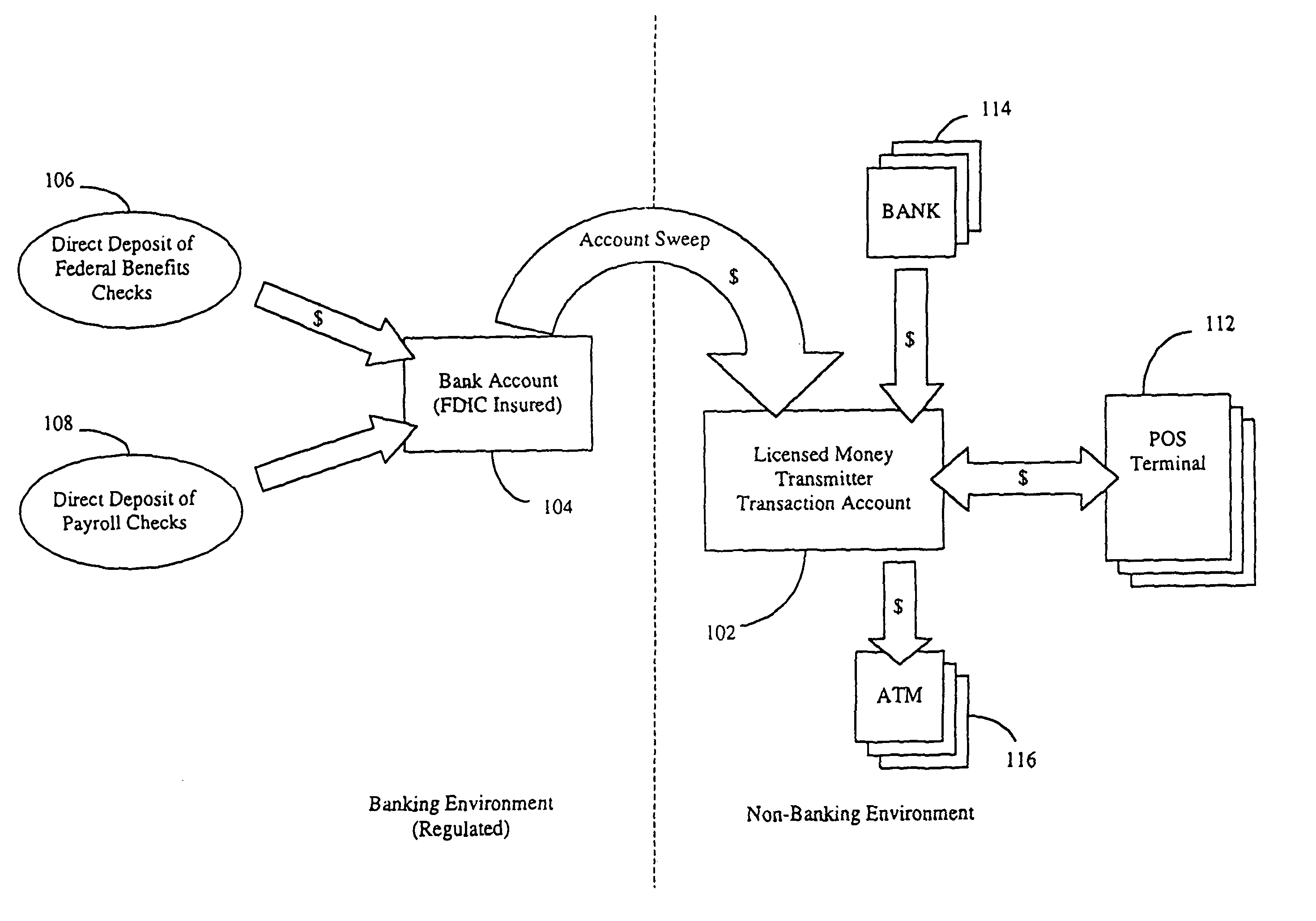

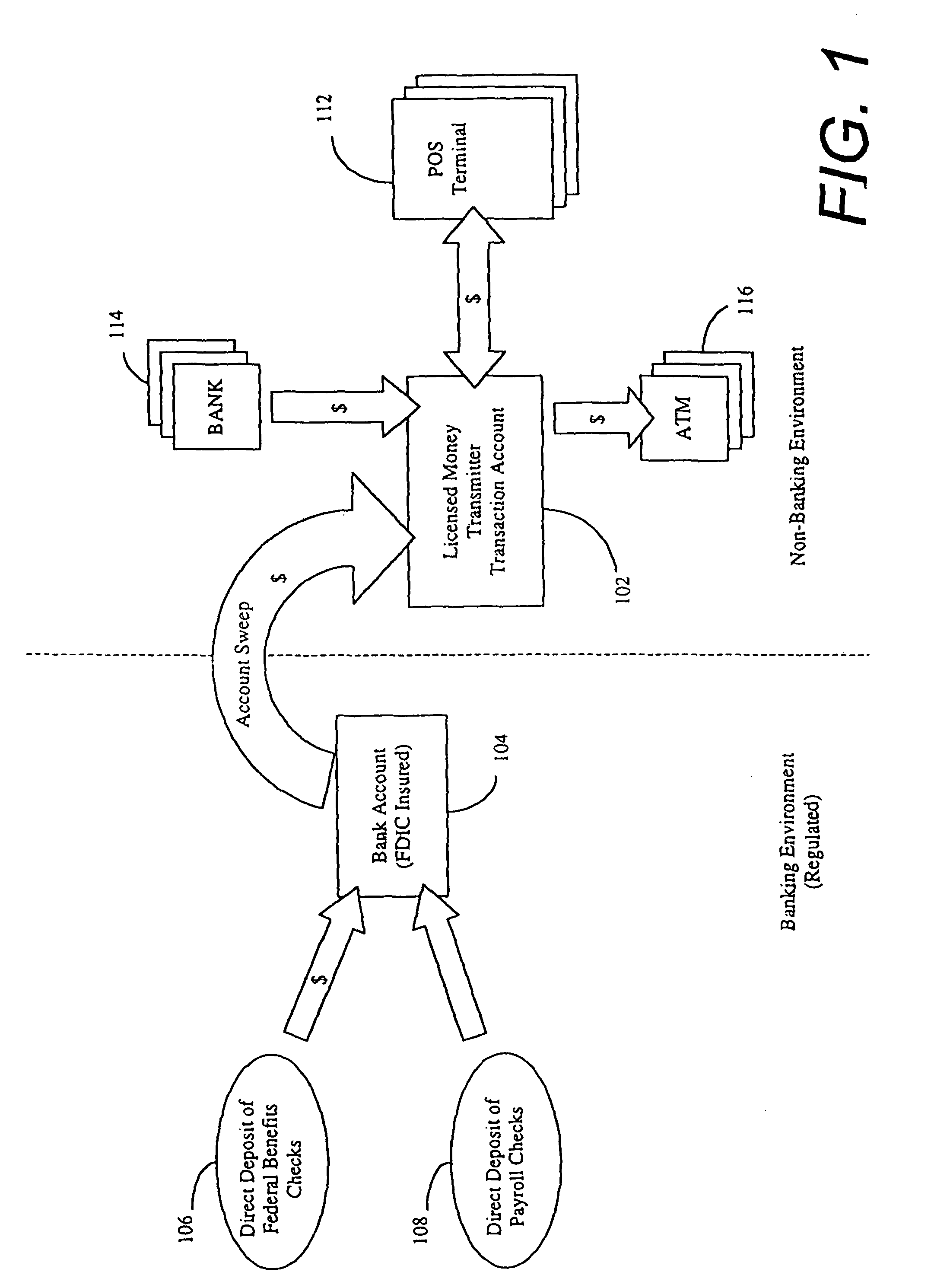

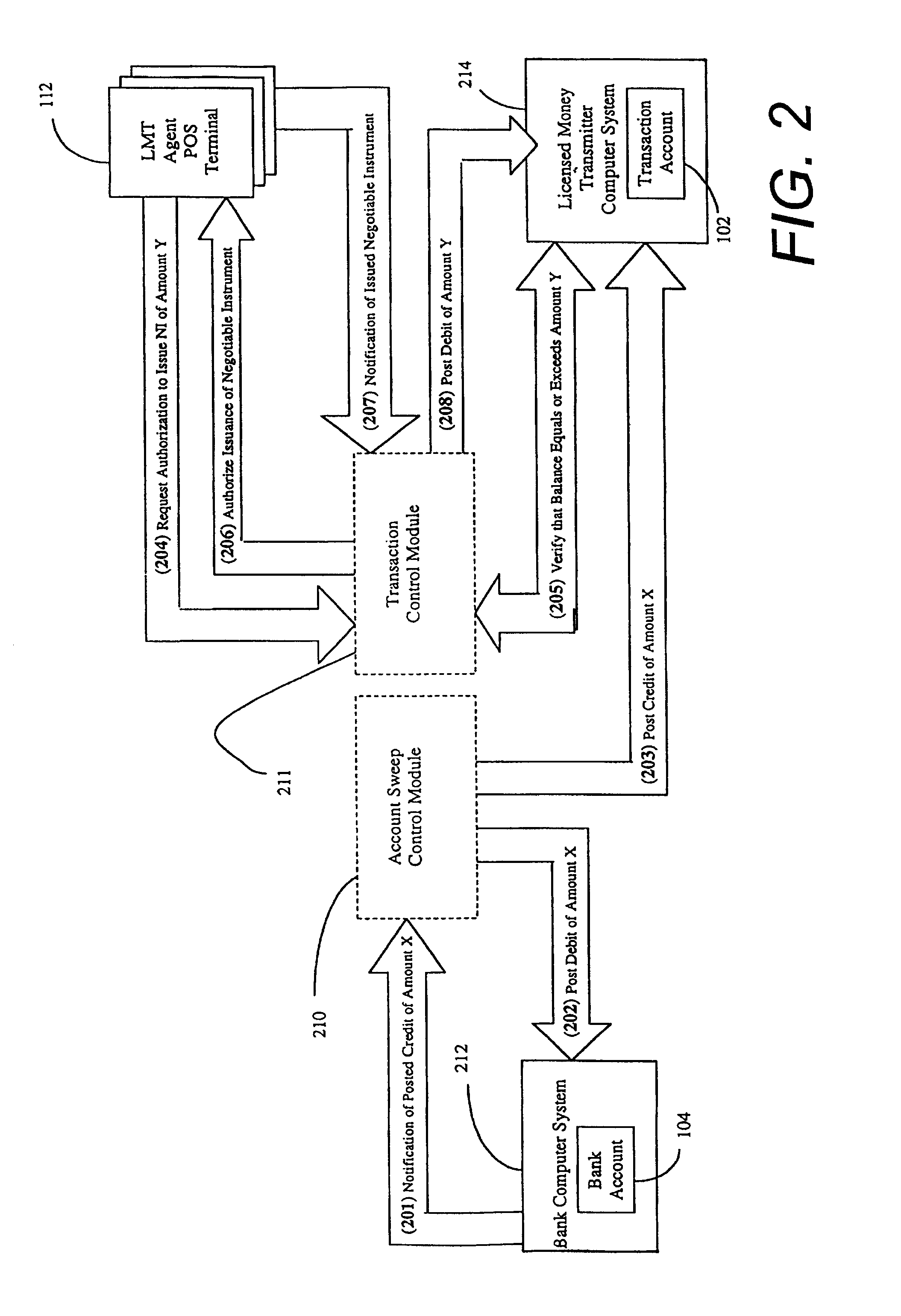

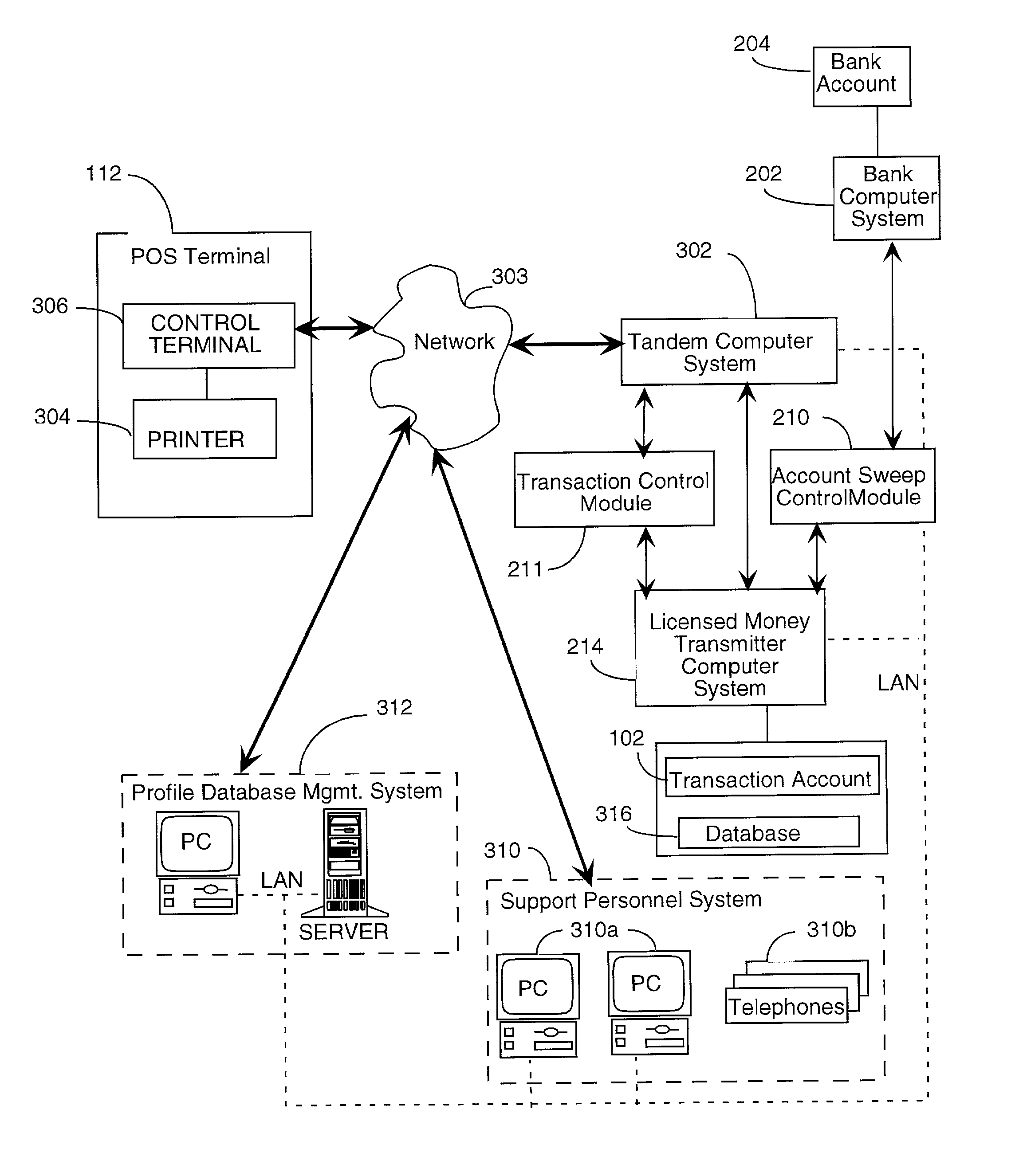

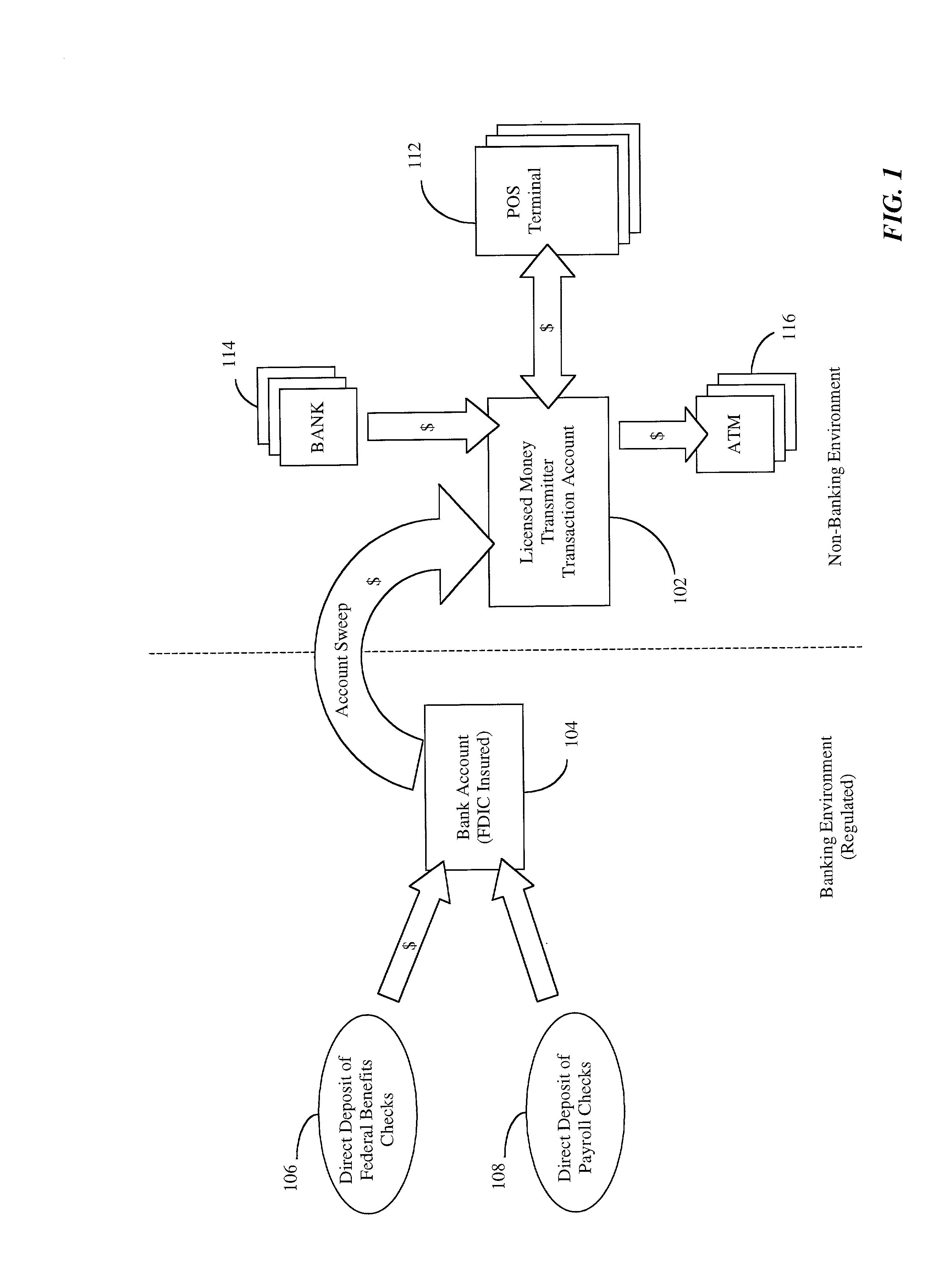

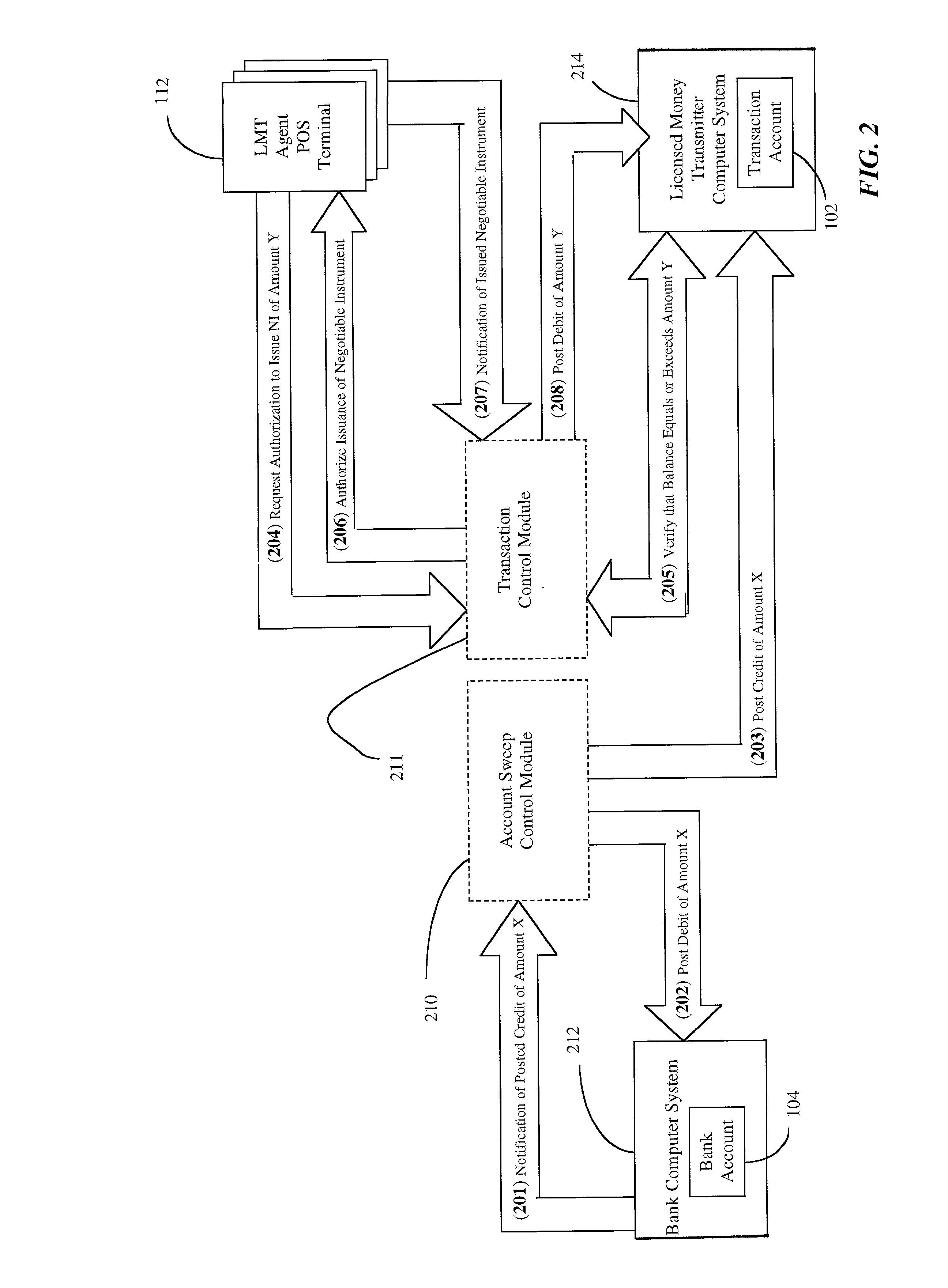

System and method for issuing negotiable instruments by licensed money transmitter from direct deposits

Systems and methods for issuing negotiable instruments by a non-bank entity such as a Licensed Money Transmitter, from direct deposits to a regulated financial institution. A customer arranges for direct deposit of funds to a regulated financial institution, such as a bank, that can receive direct deposits. When a direct deposit of funds into an account associated with the customer at the regulated financial institution is detected, the funds are swept into a second, transaction account maintained by the Licensed Money Transmitter. The customer requests issuance of a negotiable instrument from the Licensed Money Transmitter for withdrawing funds or directing that payments be made. The Licensed Money Transmitter, which maintains a network of agent terminals at various locations for disbursing funds to authorized recipients, is responsive to the request for a negotiable instrument for issuing a prepaid negotiable instrument or making payments for the benefit of the customer.

Owner:THE WESTERN UNION CO

System and method for donating to charitable organizations

A computer-implemented method of establishing an online account for a prospective user, the method comprising the steps of establishing a first account through direct deposit, the settings of the first account being stored in a database; establishing a second account, the settings of the second account being stored in the database, wherein the second account includes a debit card associated with the direct deposit account; linking the first and second accounts such that control settings of the second account are determined through the first account; and making a donation from the second account using the debit card consistent with the control settings of the second account.

Owner:VIRTUAL PIGGY INC

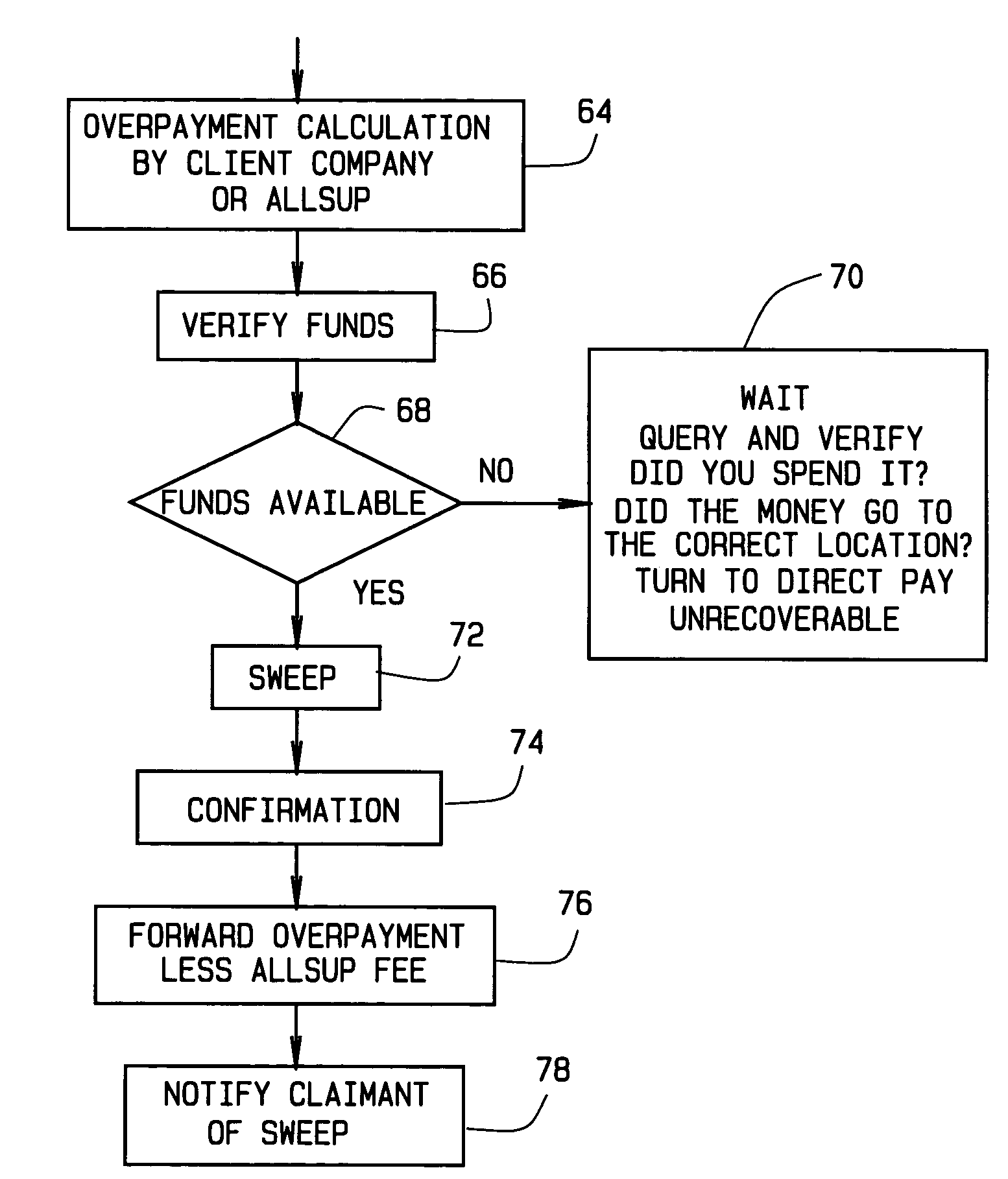

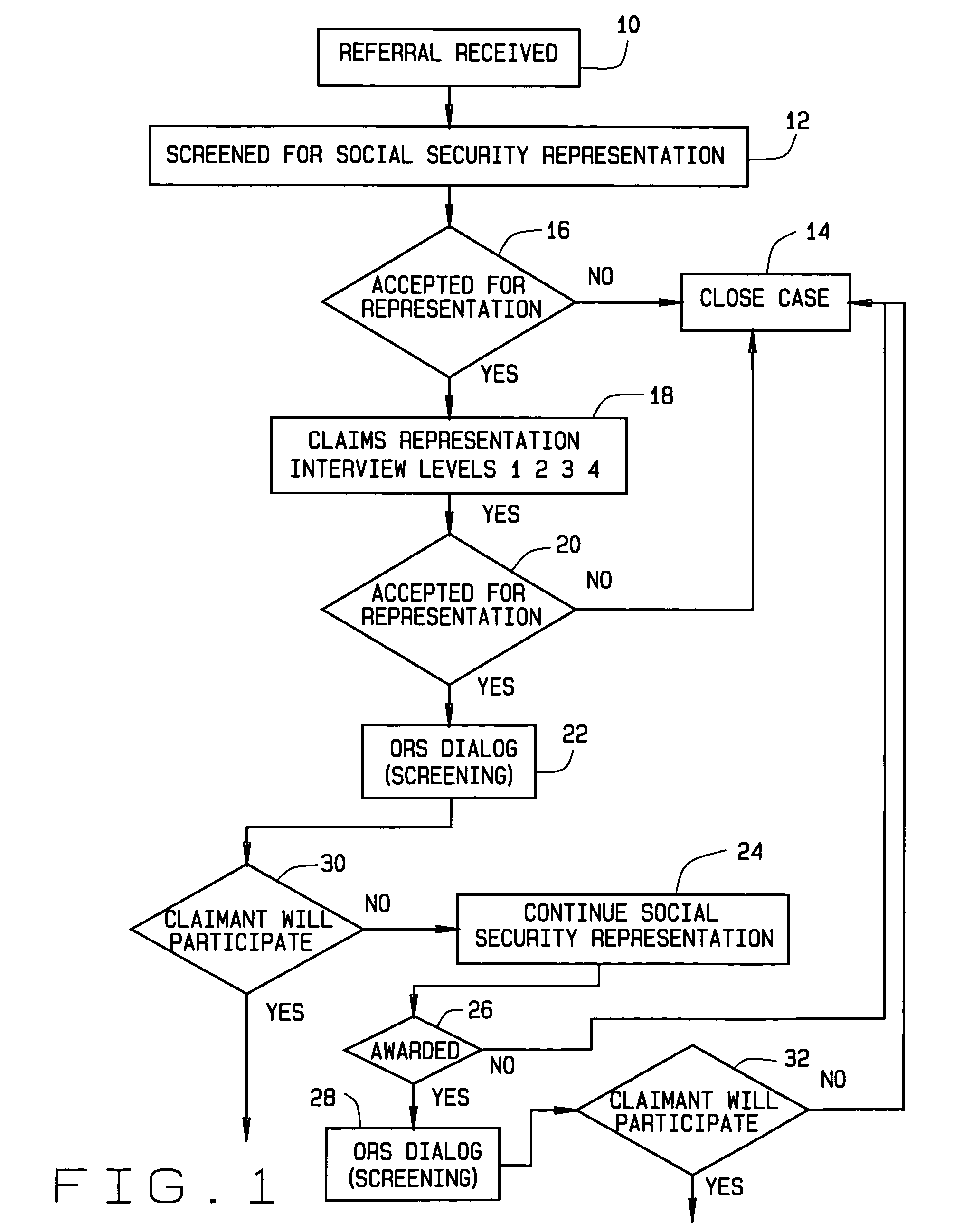

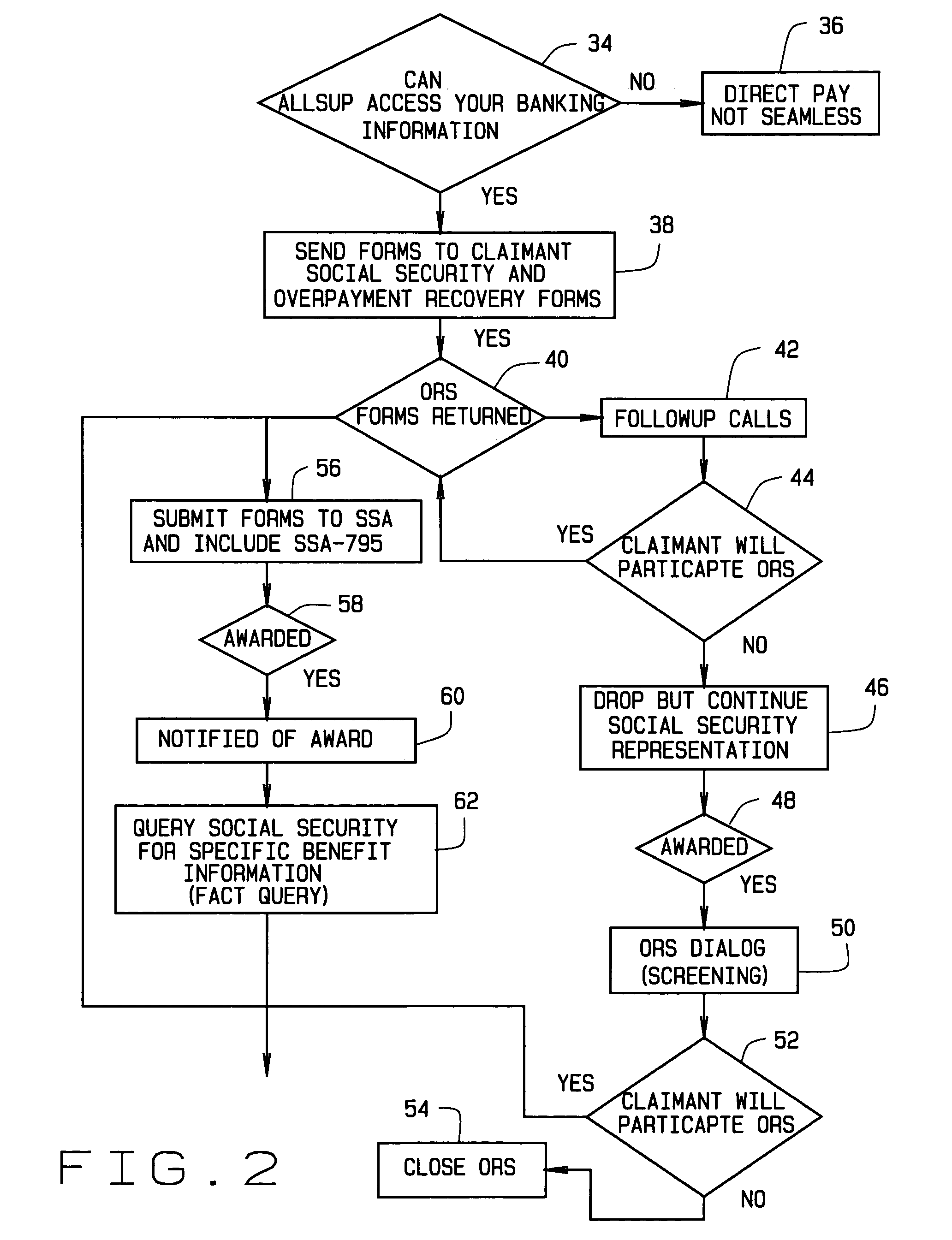

Long term disability overpayment recovery service with provision of medical services and medical products

A method of obtaining Social Security disability benefits for uninsured individuals and providing medical services and medical products during the pendency of a claim for the Social Security disability benefits. The method provides for filing a claim for Social Security disability insurance payments and securing needed medical services and products for the individual, without full payment, during the pendency of the claim. The individual establishes a direct deposit account for deposit of the Social Security disability insurance payment and authorizes an electronic removal of funds from the account upon deposit of retroactive or future Social Security disability insurance payments to pay for the medical services and medical products.

Owner:ALLSUP LLC

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com