Patents

Literature

3906 results about "Payment system" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

A payment system is any system used to settle financial transactions through the transfer of monetary value. This includes the institutions, instruments, people, rules, procedures, standards, and technologies that make it exchange possible. A common type of payment system is called an operational network that links bank accounts and provides for monetary exchange using bank deposits. Some payment systems also include credit mechanisms, which are essentially a different aspect of payment.

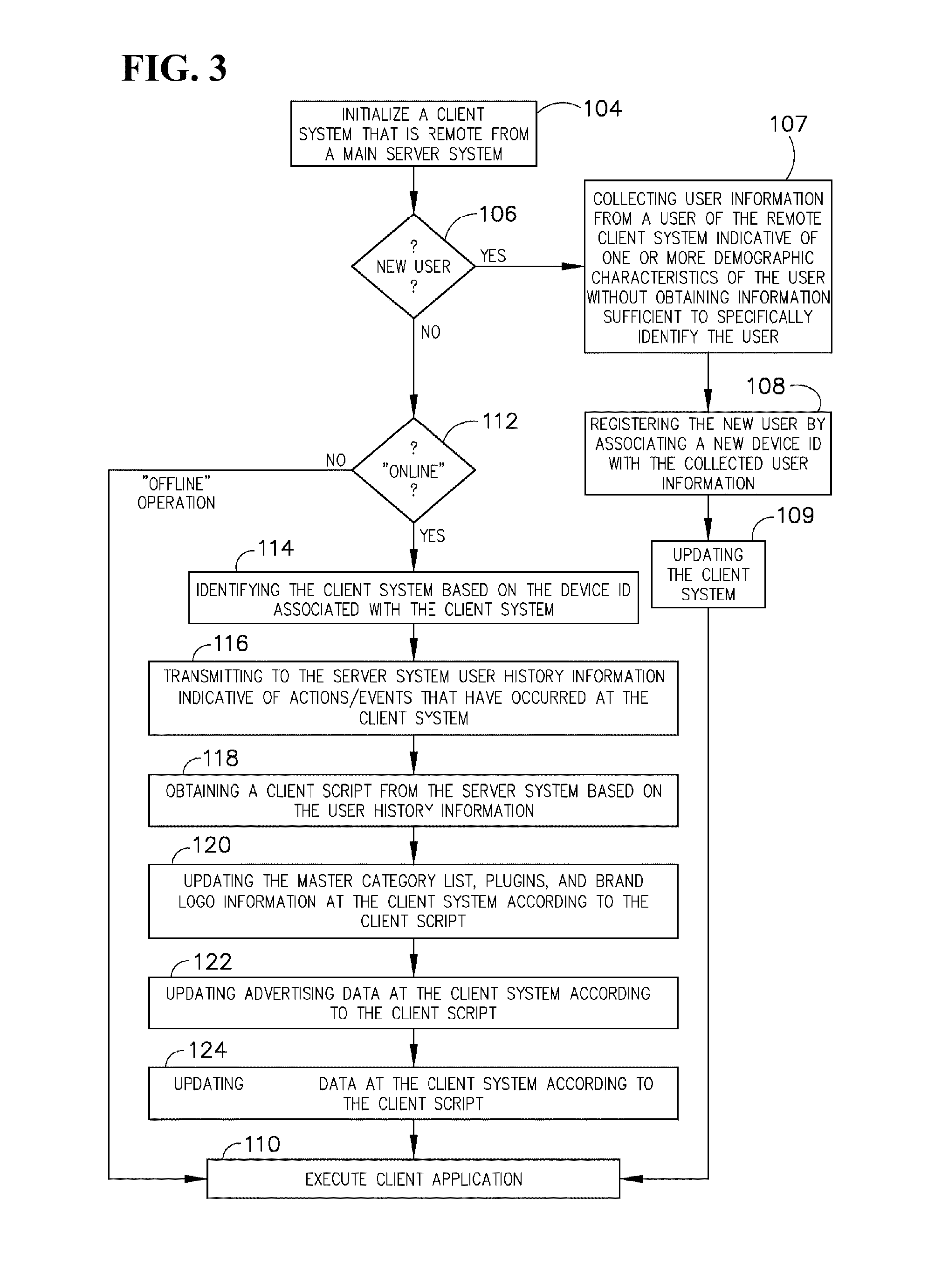

Systems and Methods to Target Predictive Location Based Content and Track Conversions

ActiveUS20080248815A1Particular environment based servicesDevices with GPS signal receiverCommunications systemMobile device

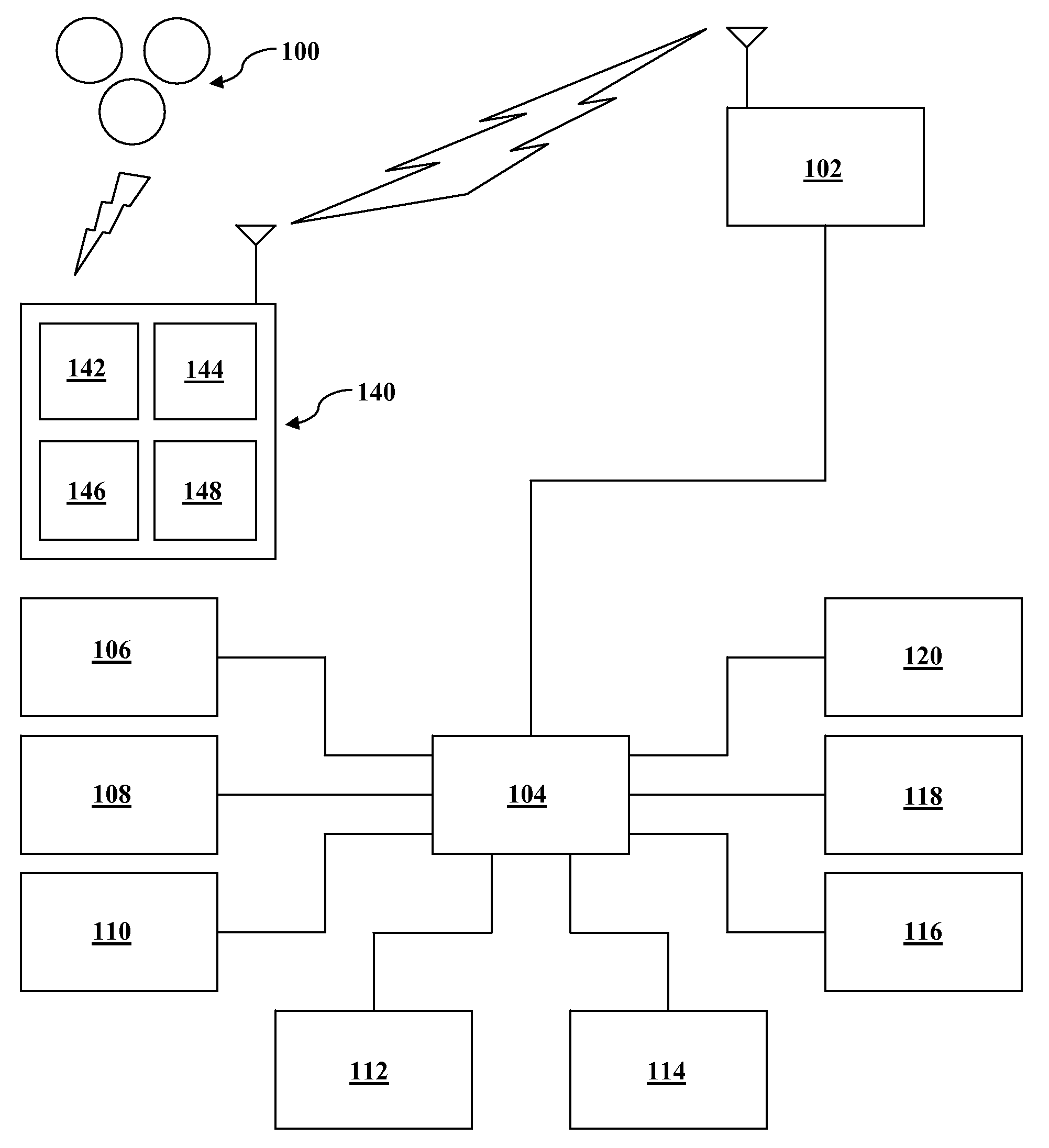

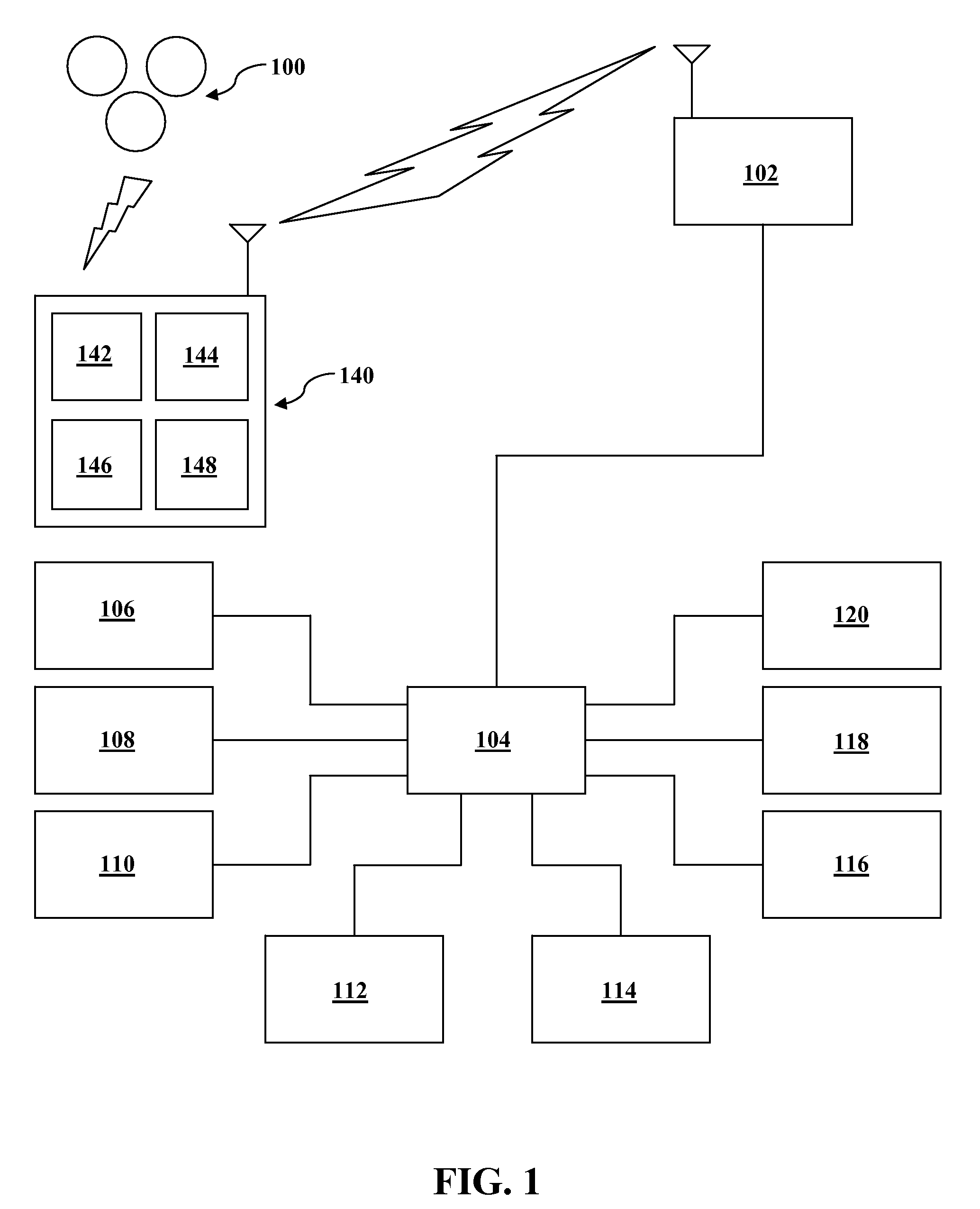

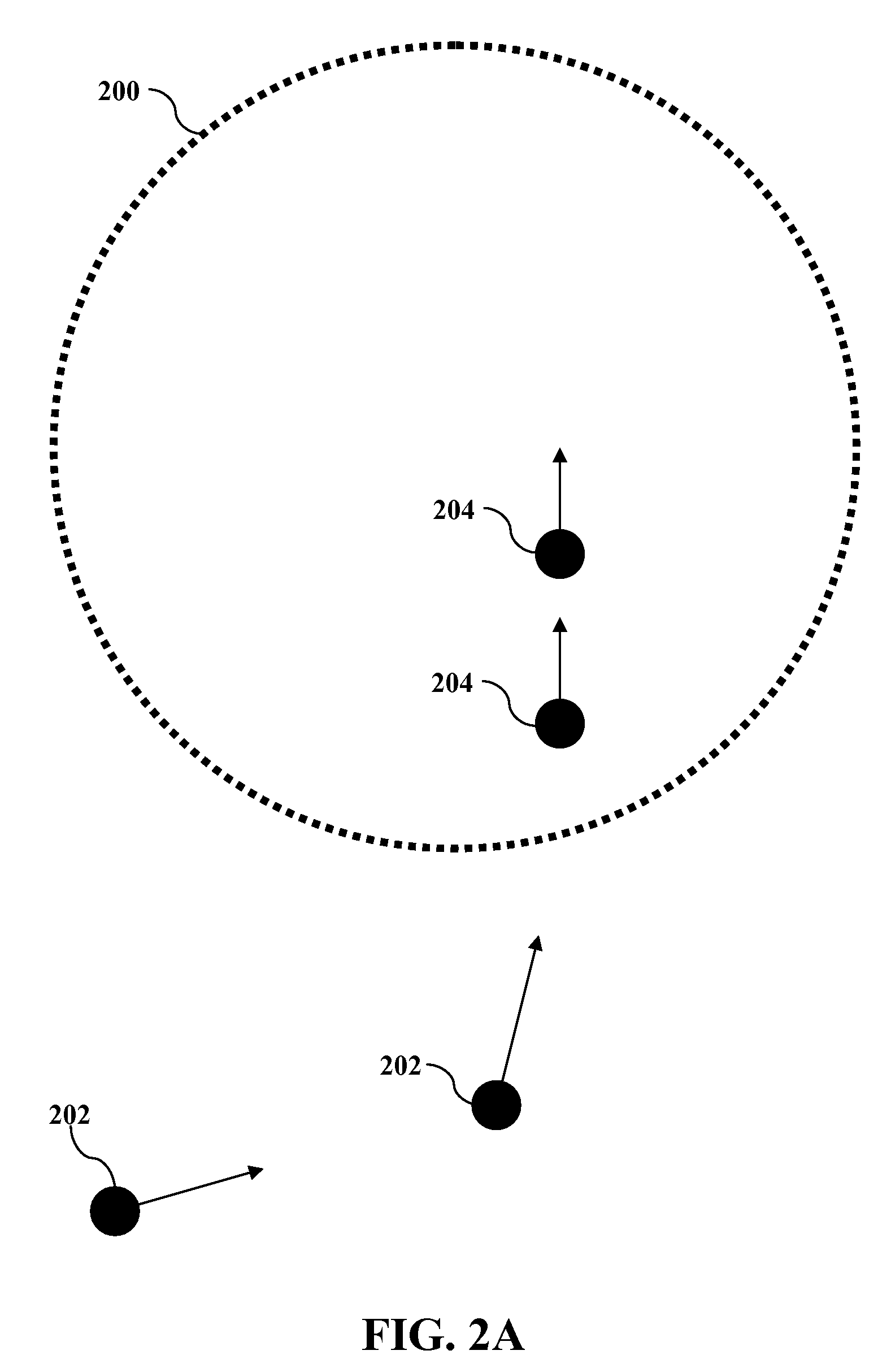

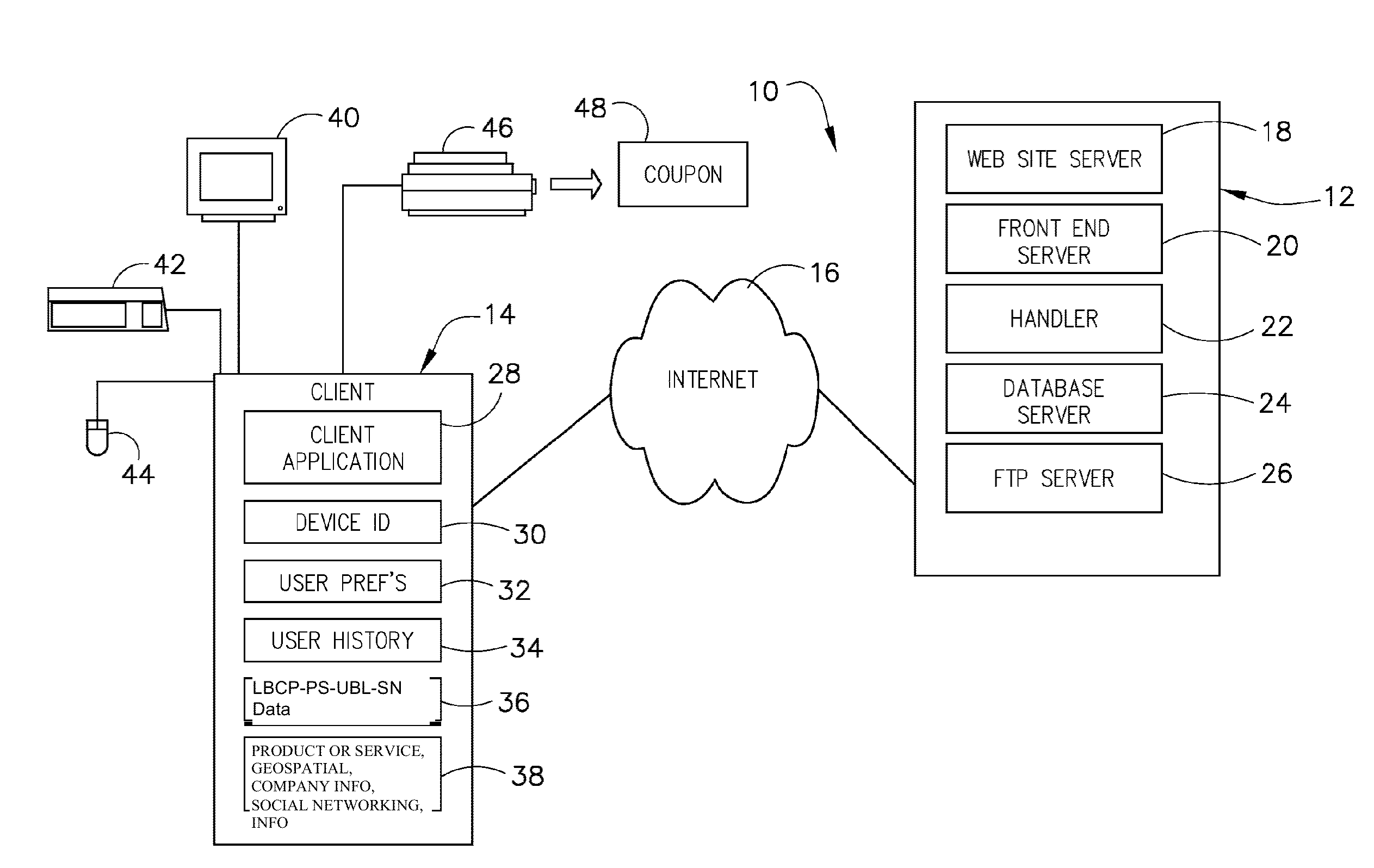

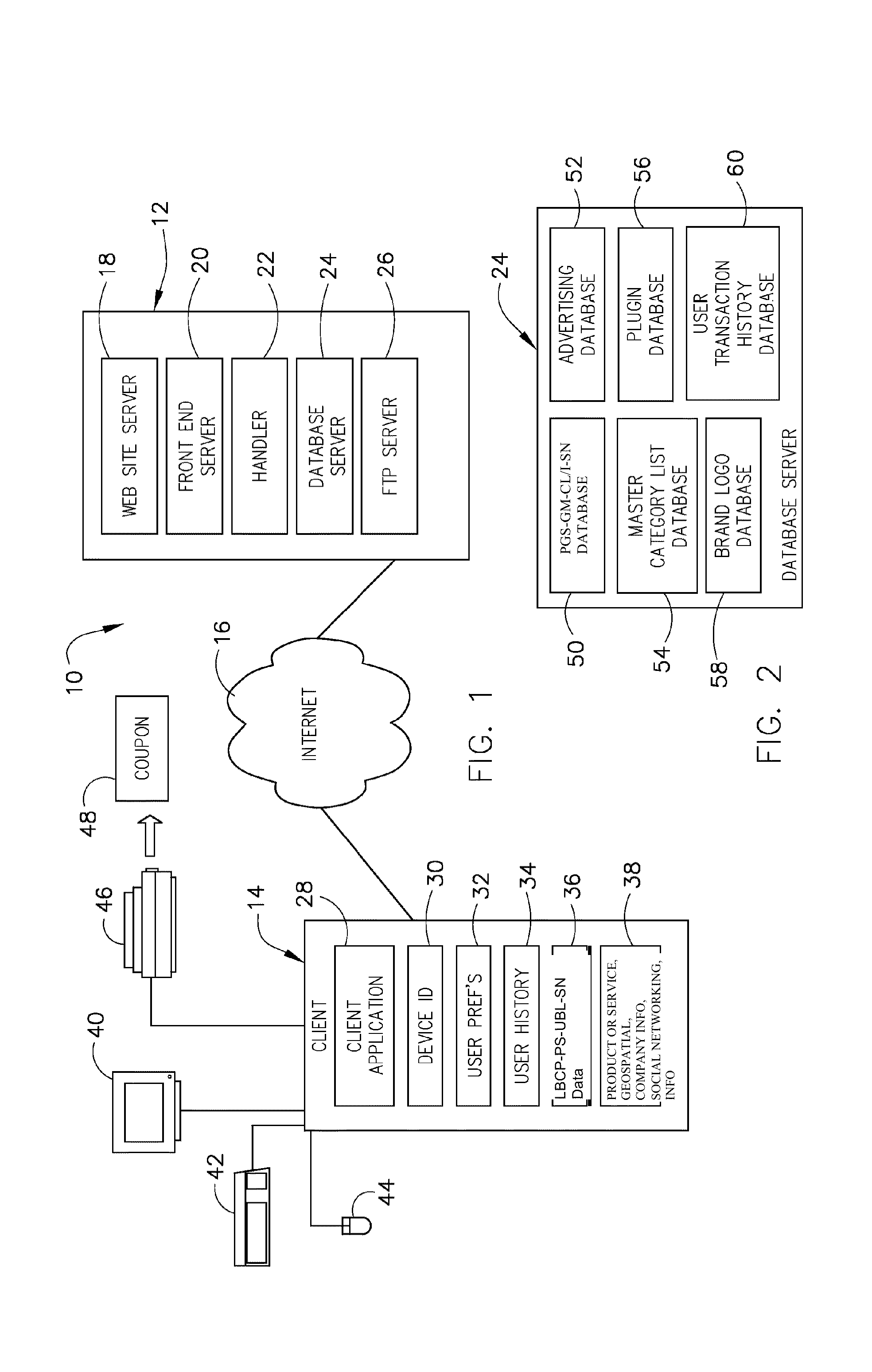

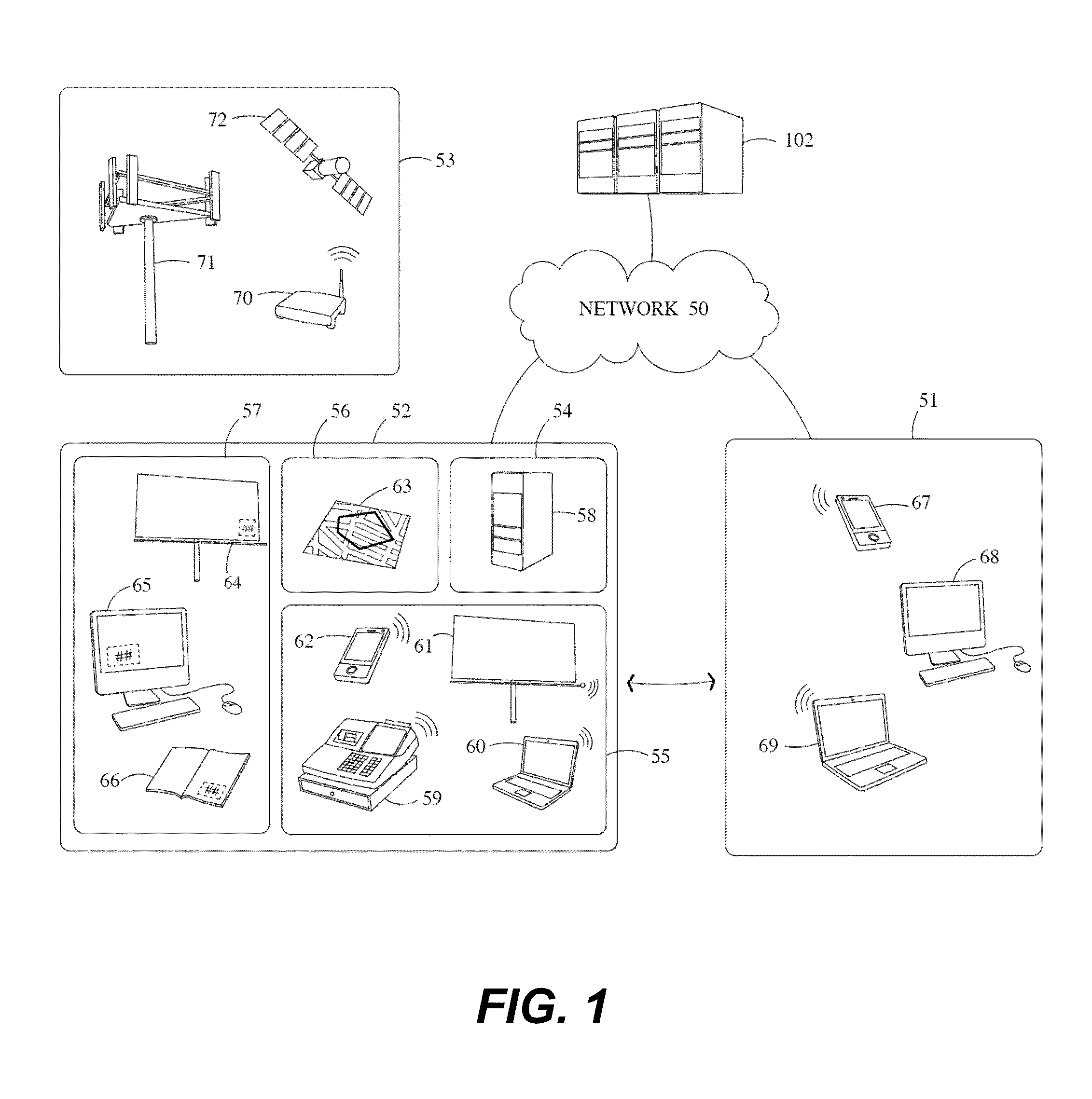

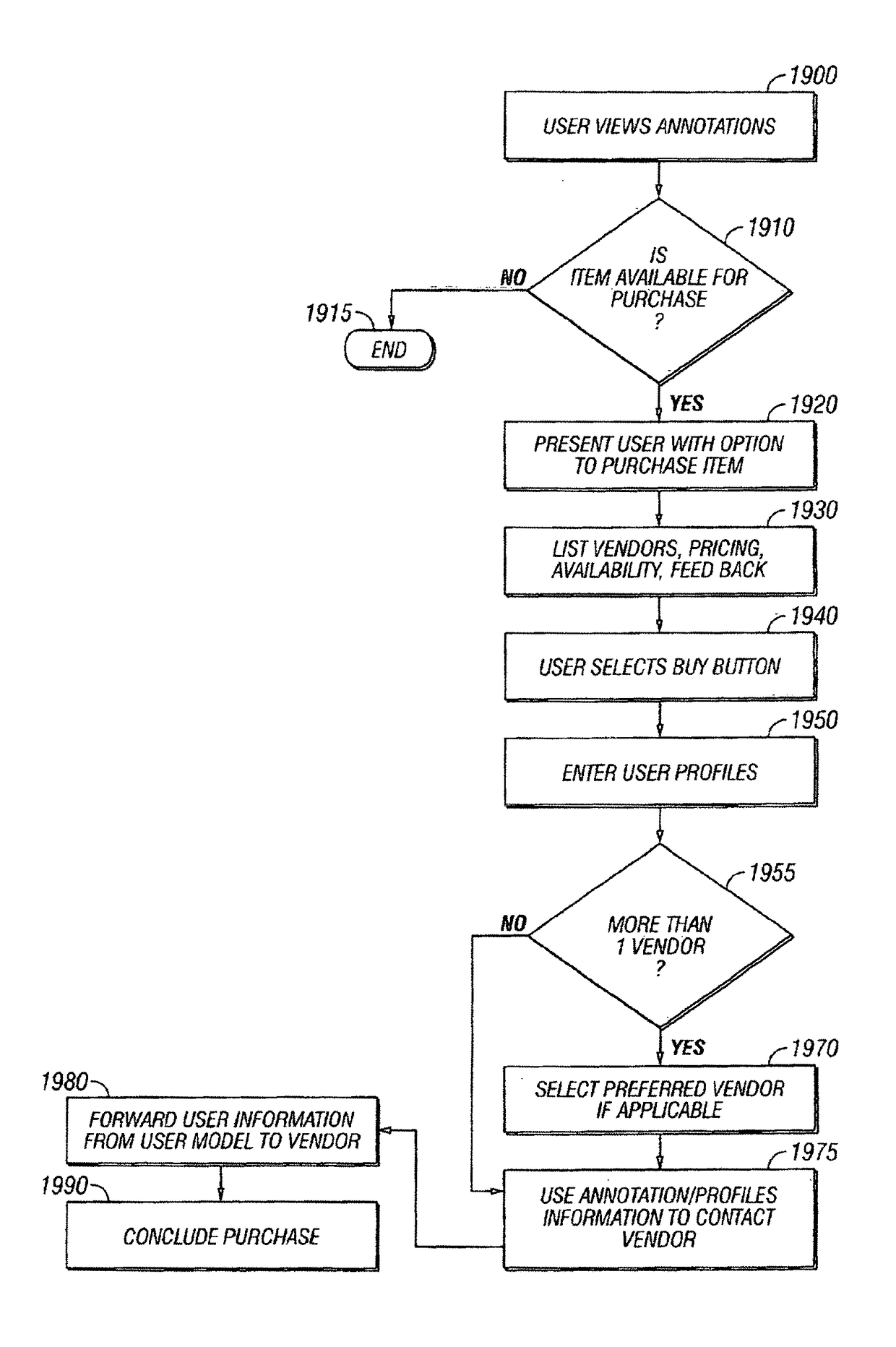

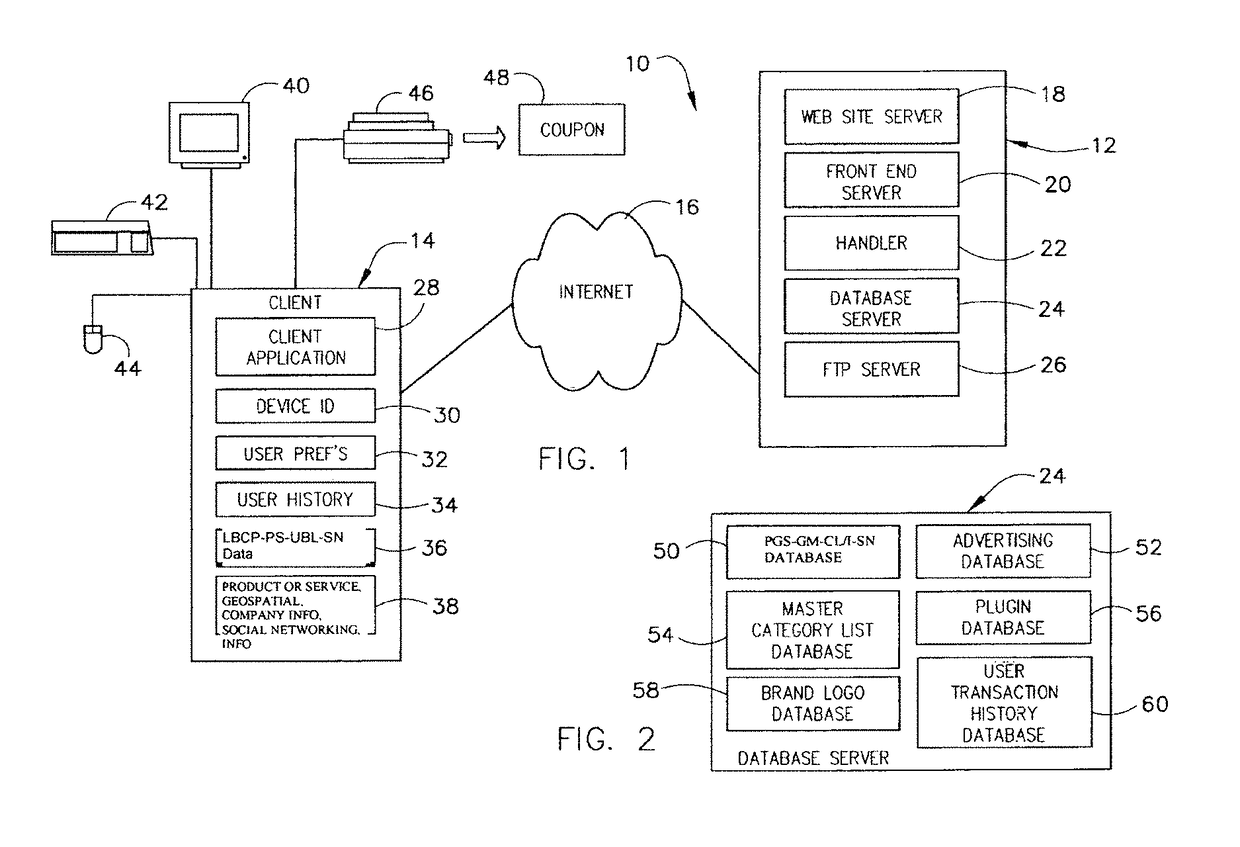

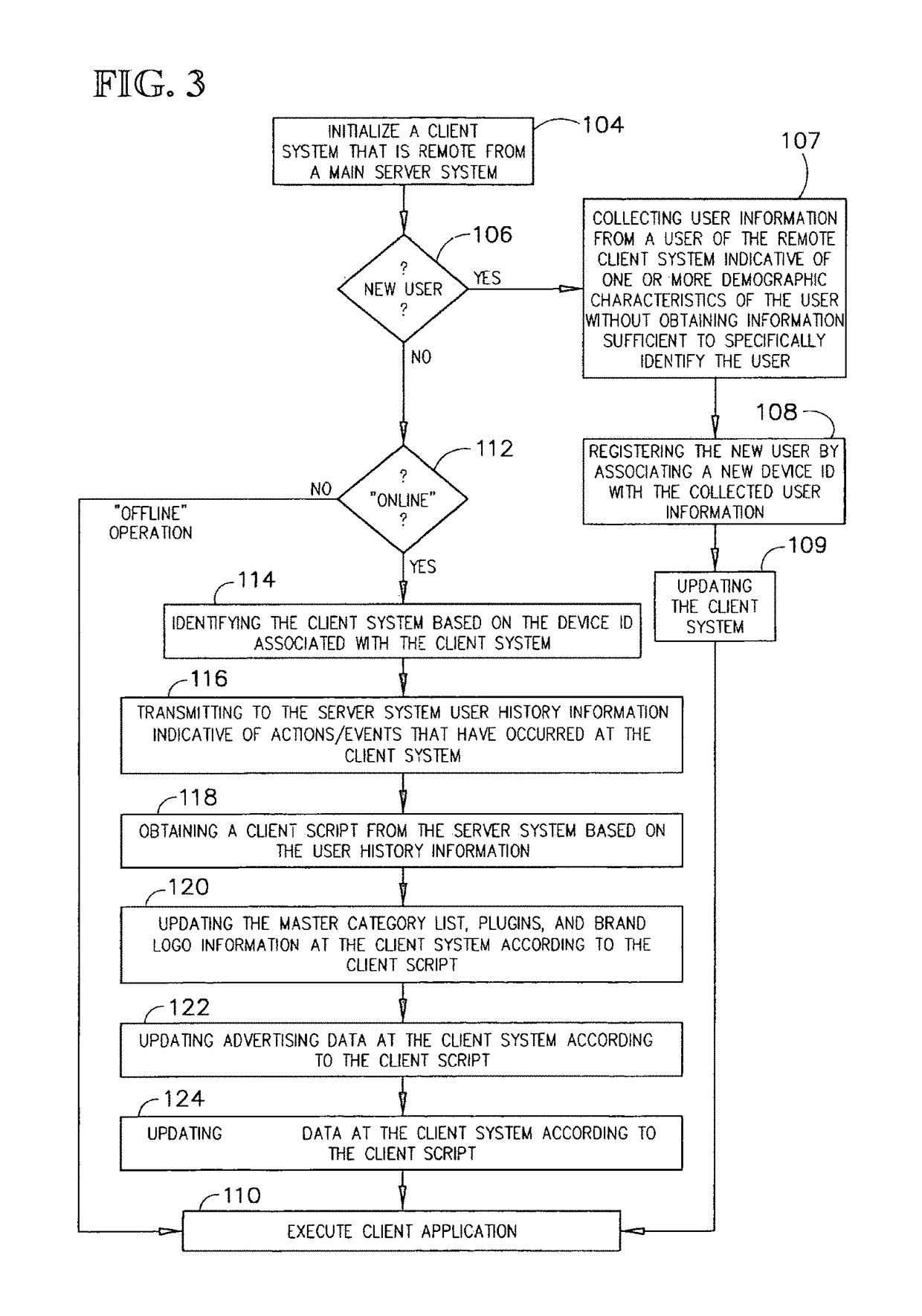

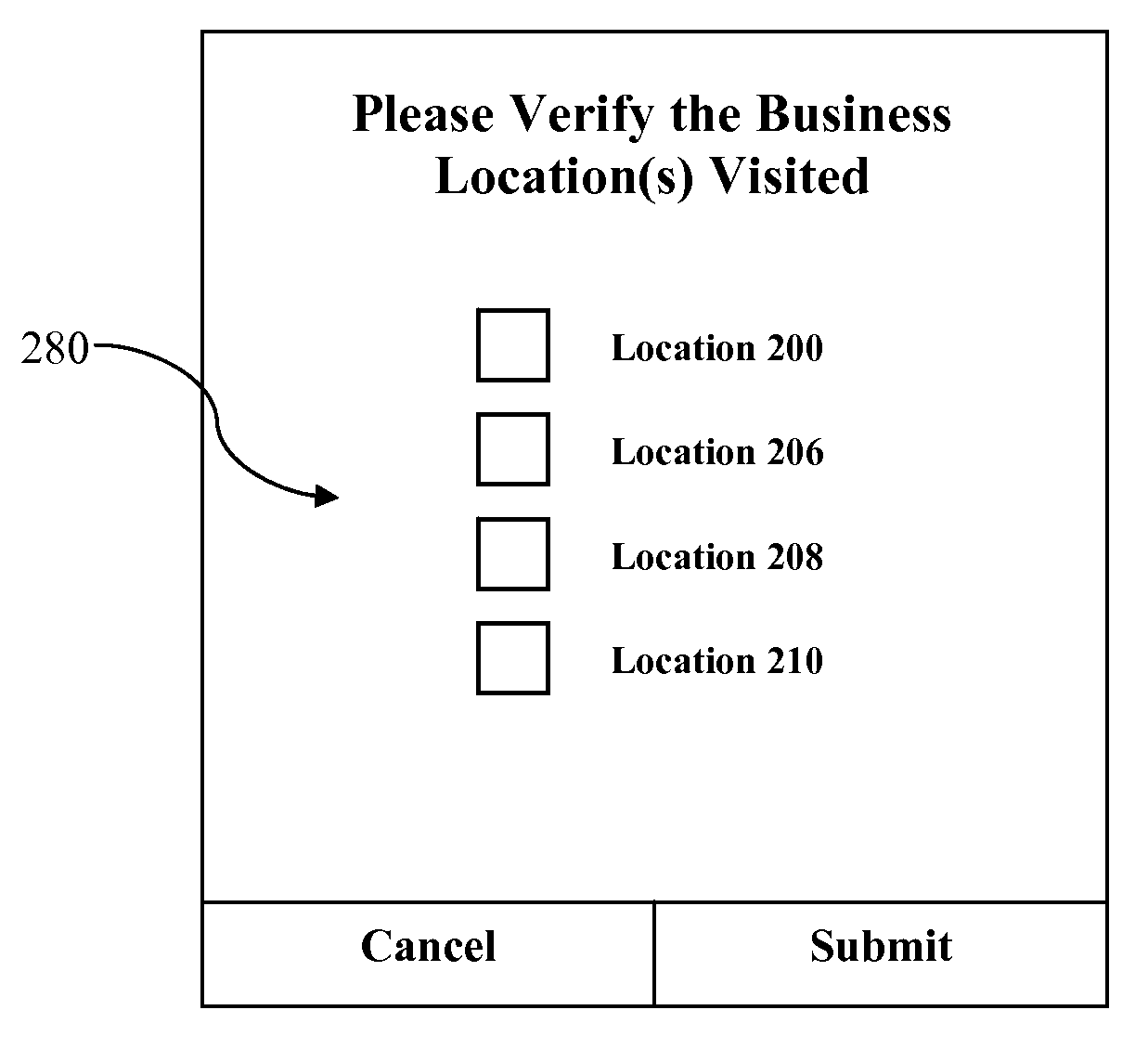

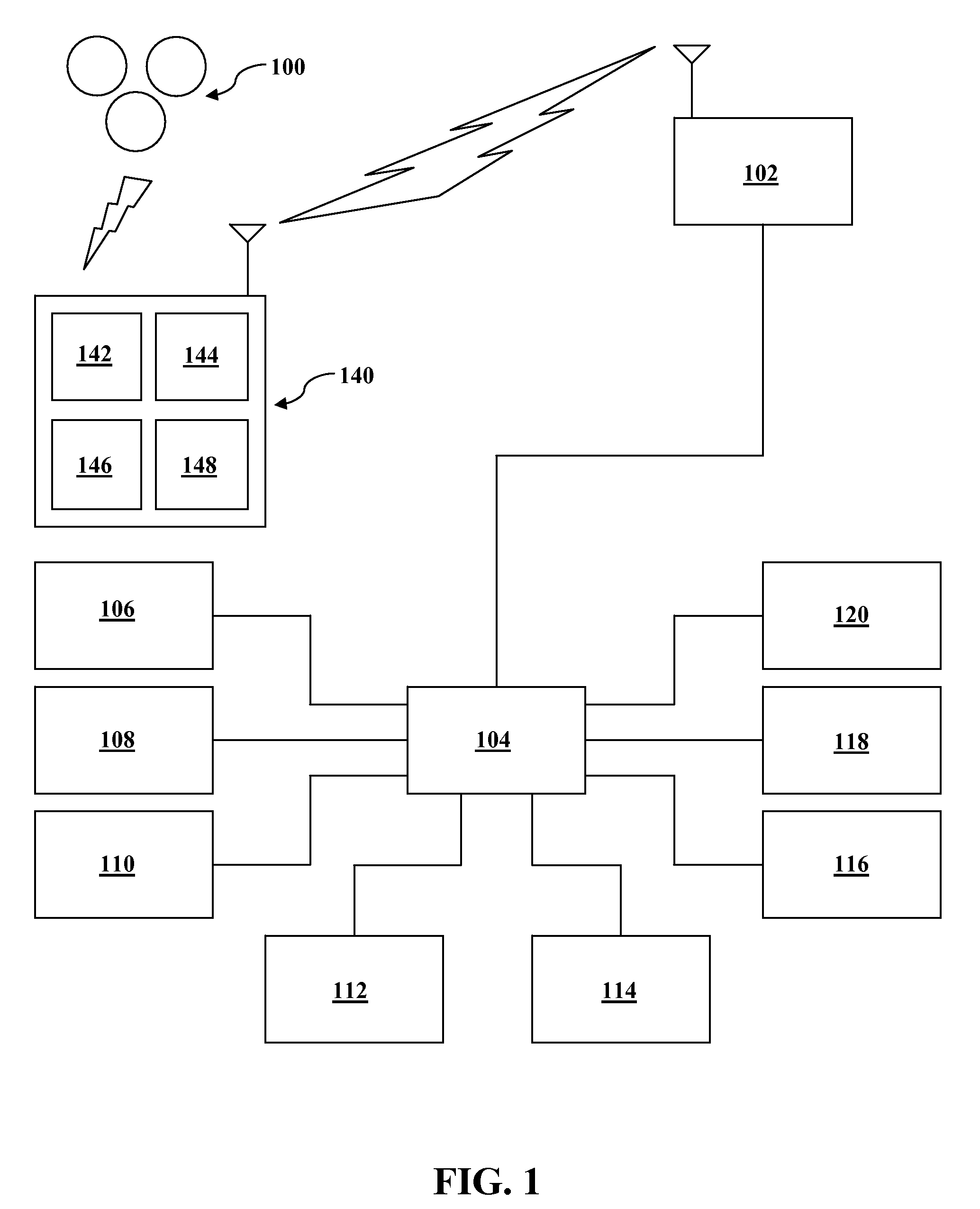

Methods and systems that record the location of a user and transmit targeted content to a user based upon their current and past location information. A network is configured to include a server programmed with a database of targeted content, a database of location information, a database of user information, a database searching algorithm, and a wireless communication system capable of communicating with the user's mobile device. The location of the mobile device is ascertained and recorded. The location information is analyzed to determine the routes taken by the user, businesses visited by the user, and other behaviors of the user. Targeted content is sent to the mobile device of the user and whether the user visits the physical locations associated with the targeted content is monitored. Payment systems, phone exchange systems, and other features may also be integrated to provide detailed conversion tracking to producers of targeted content and business owners.

Owner:META PLATFORMS INC

Mobile Person-to-Person Payment System

InactiveUS20070255653A1Easy to useFraudulent transaction is minimizedFinancePayment architectureBarcodeFinancial transaction

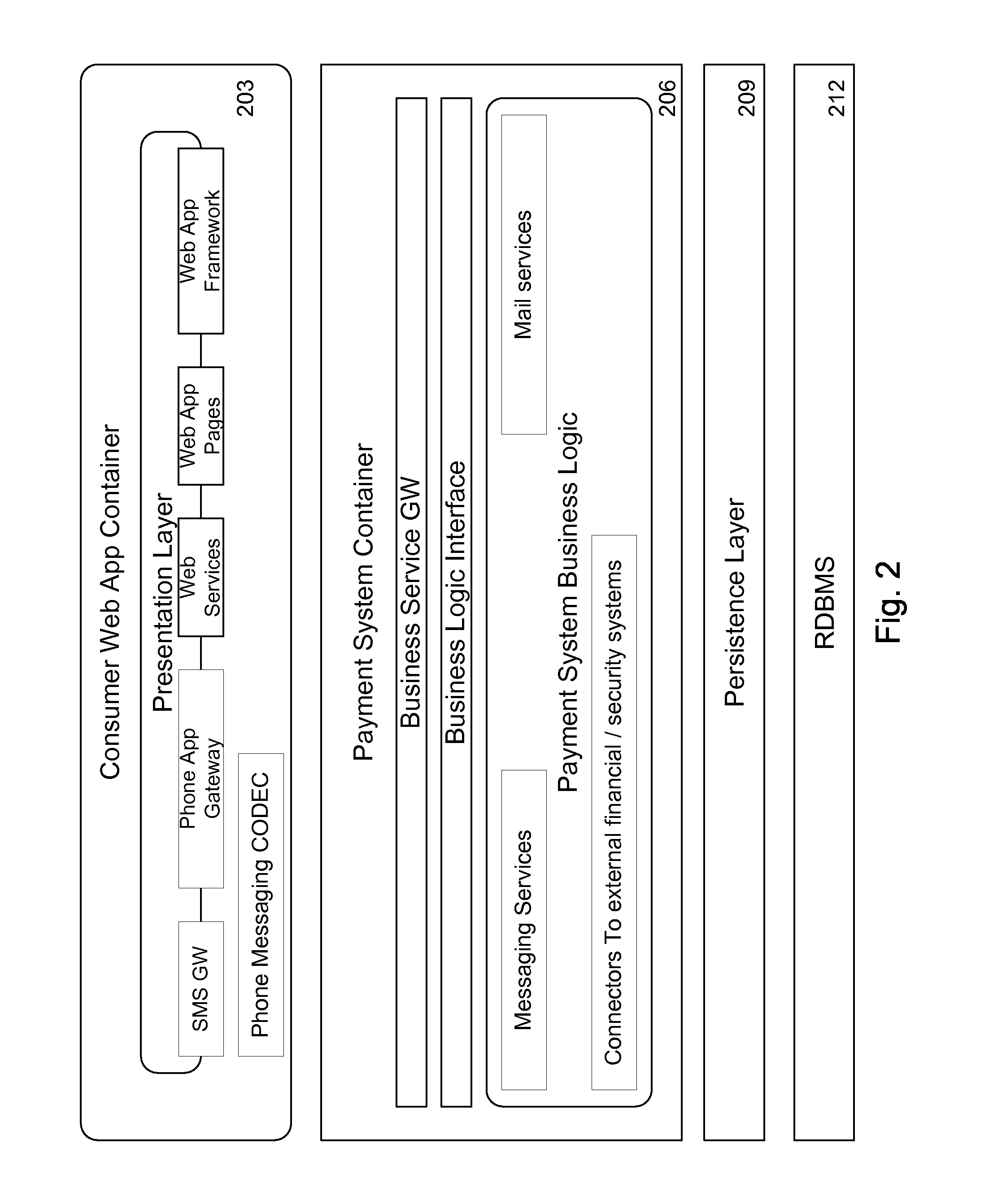

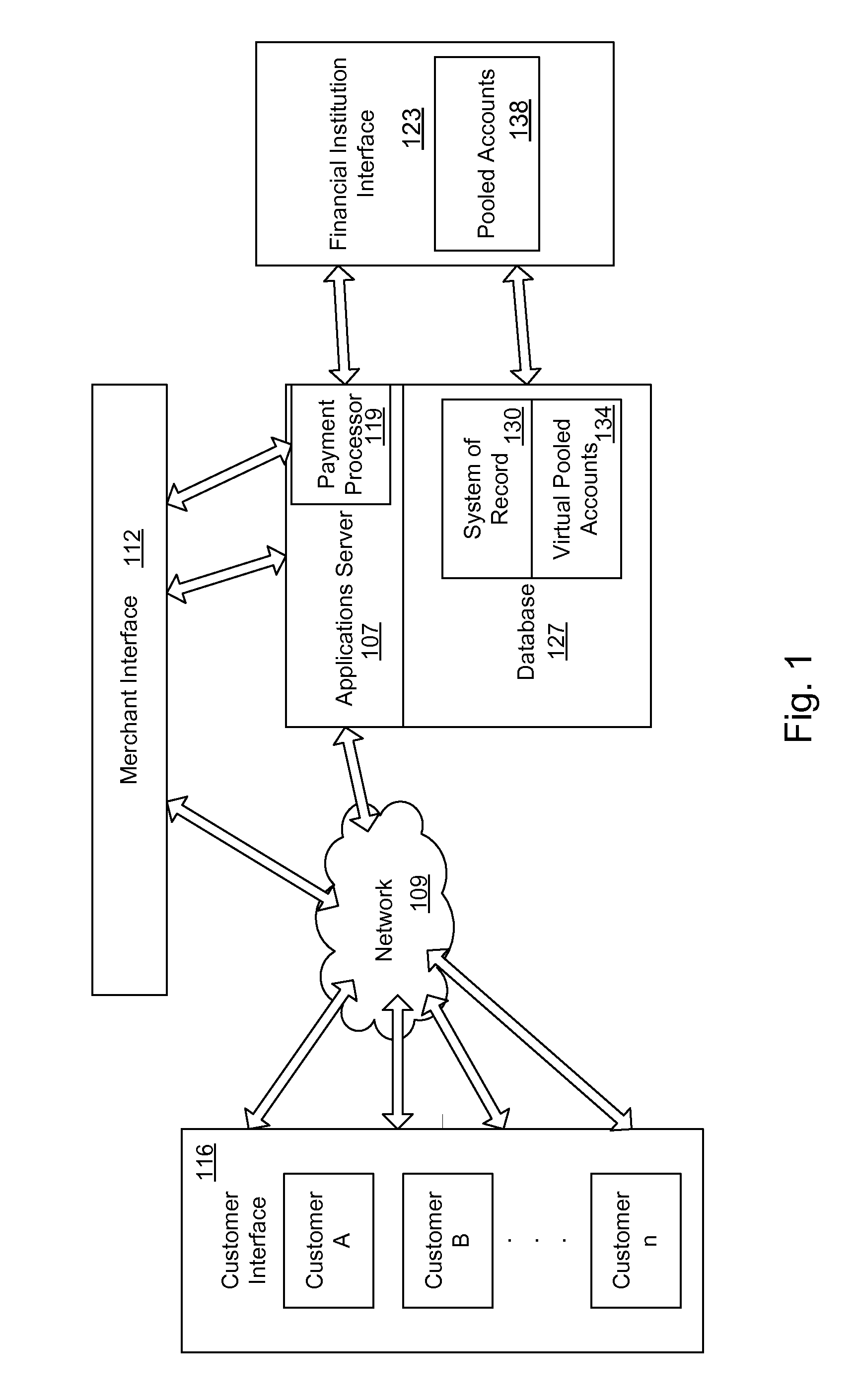

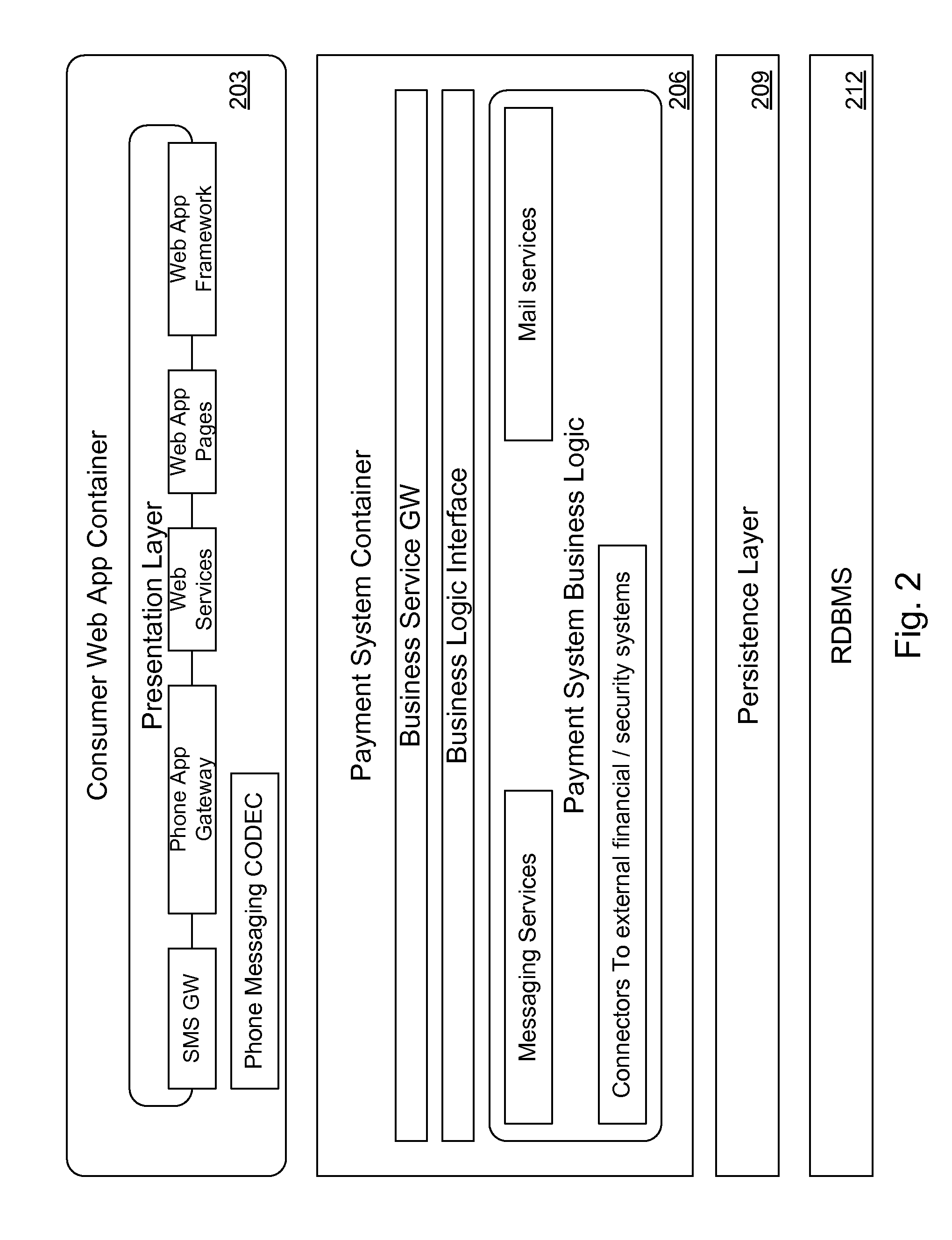

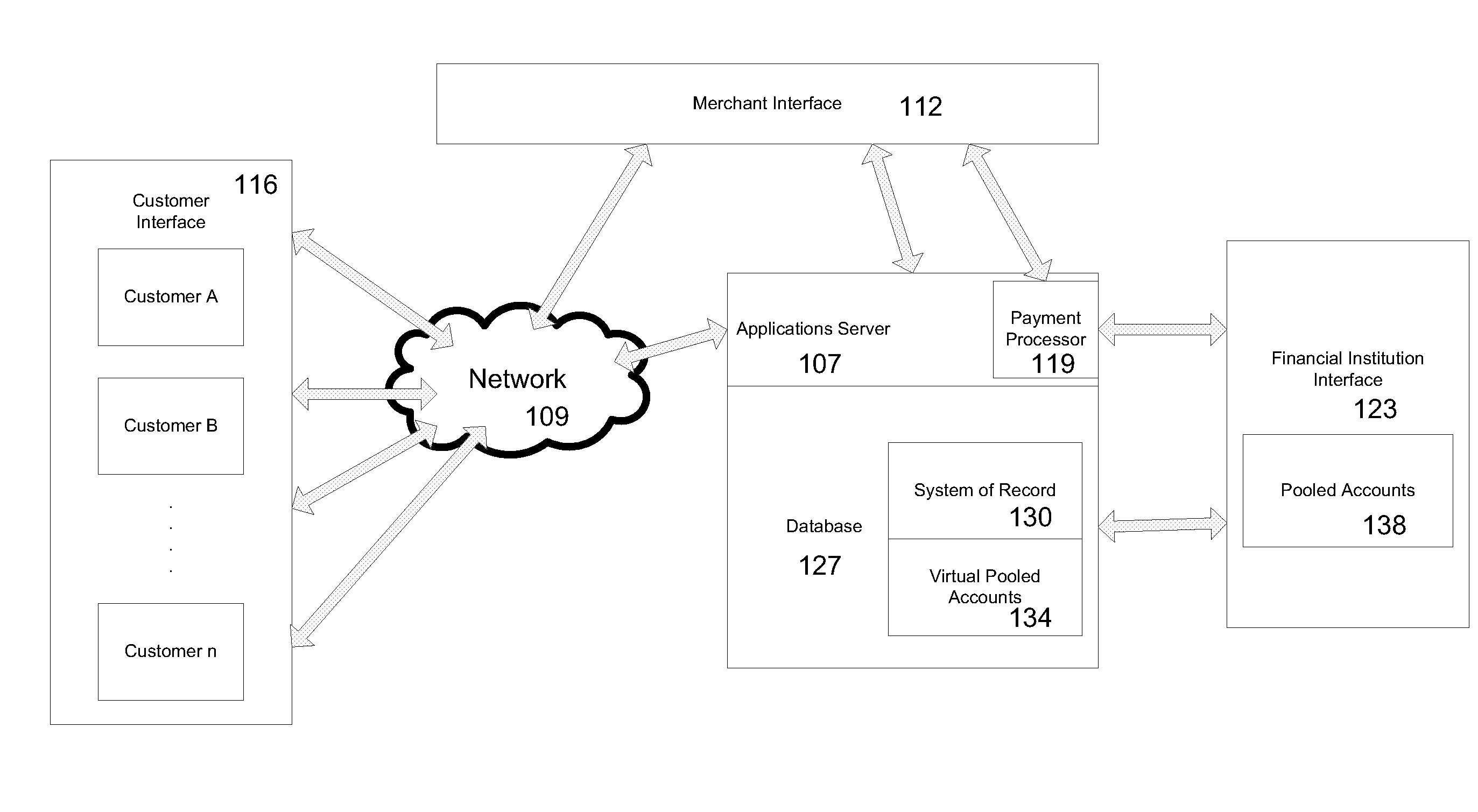

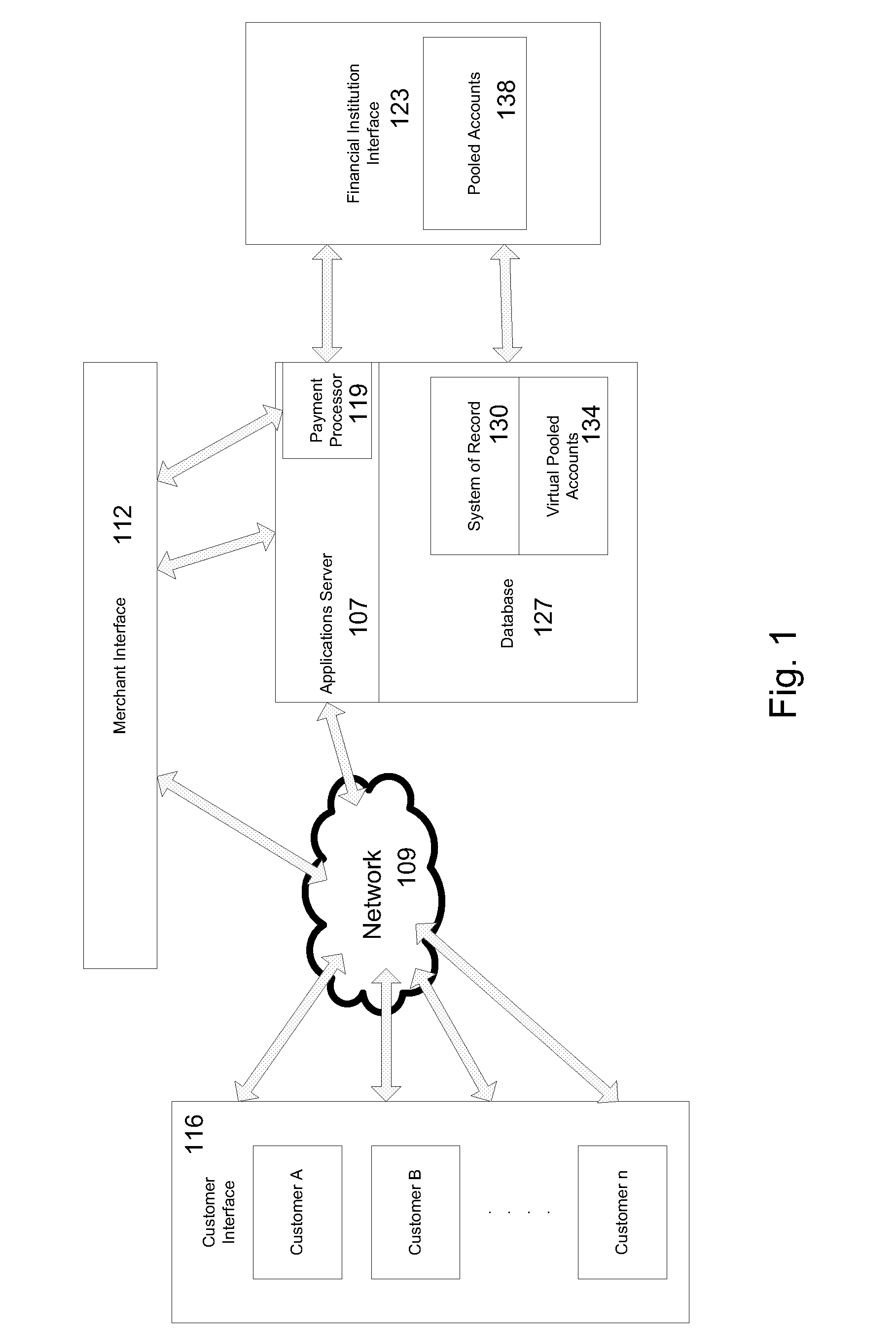

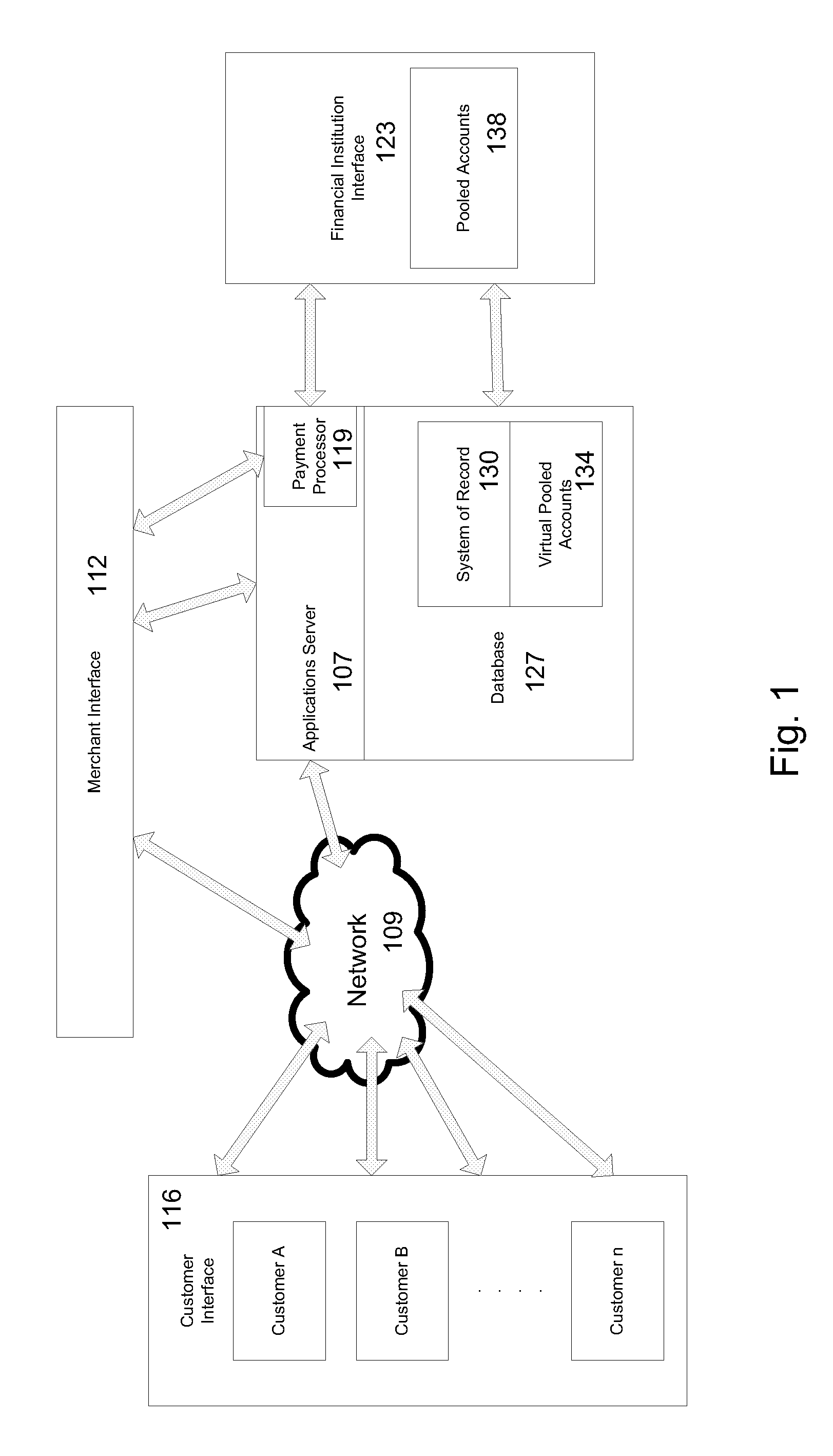

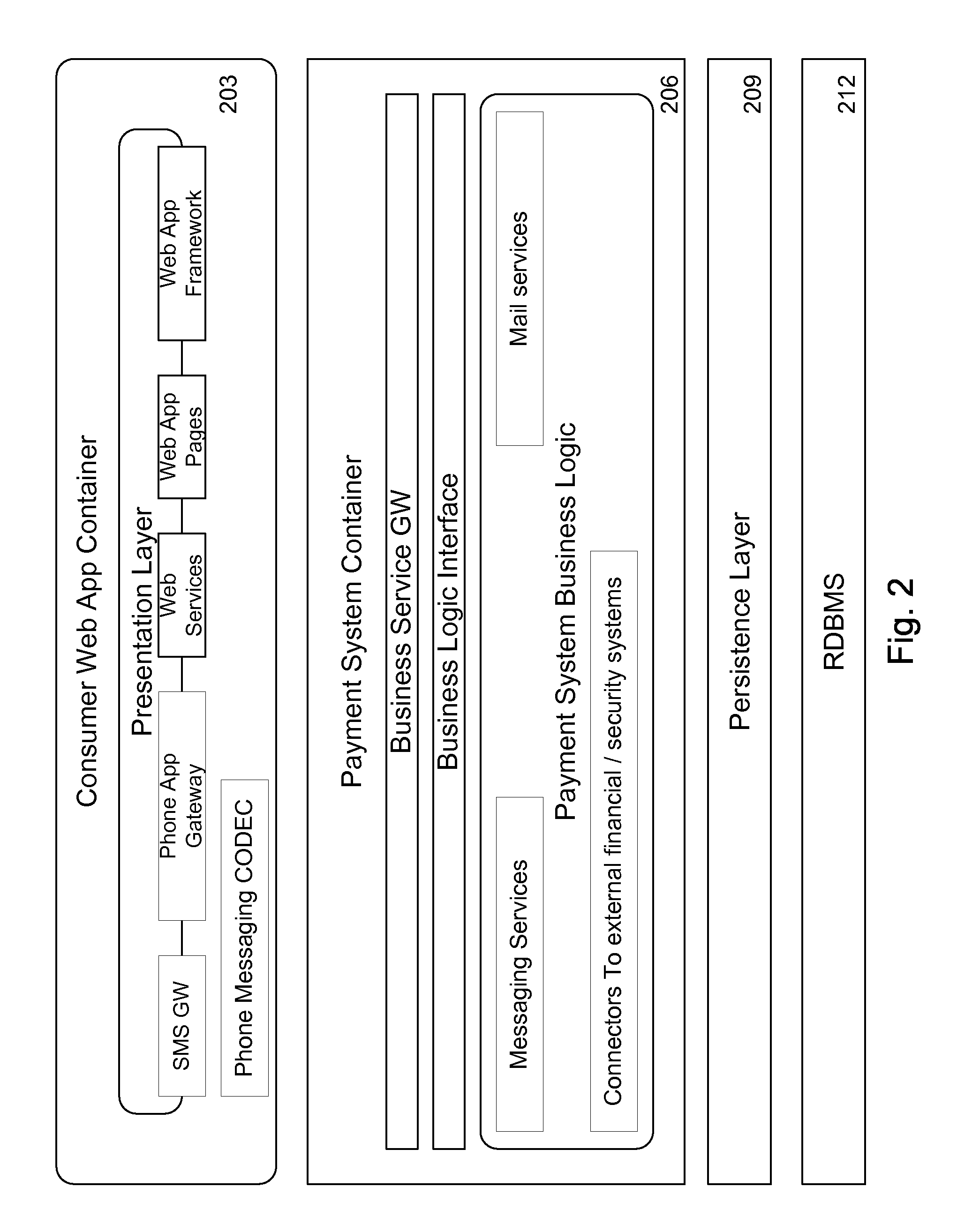

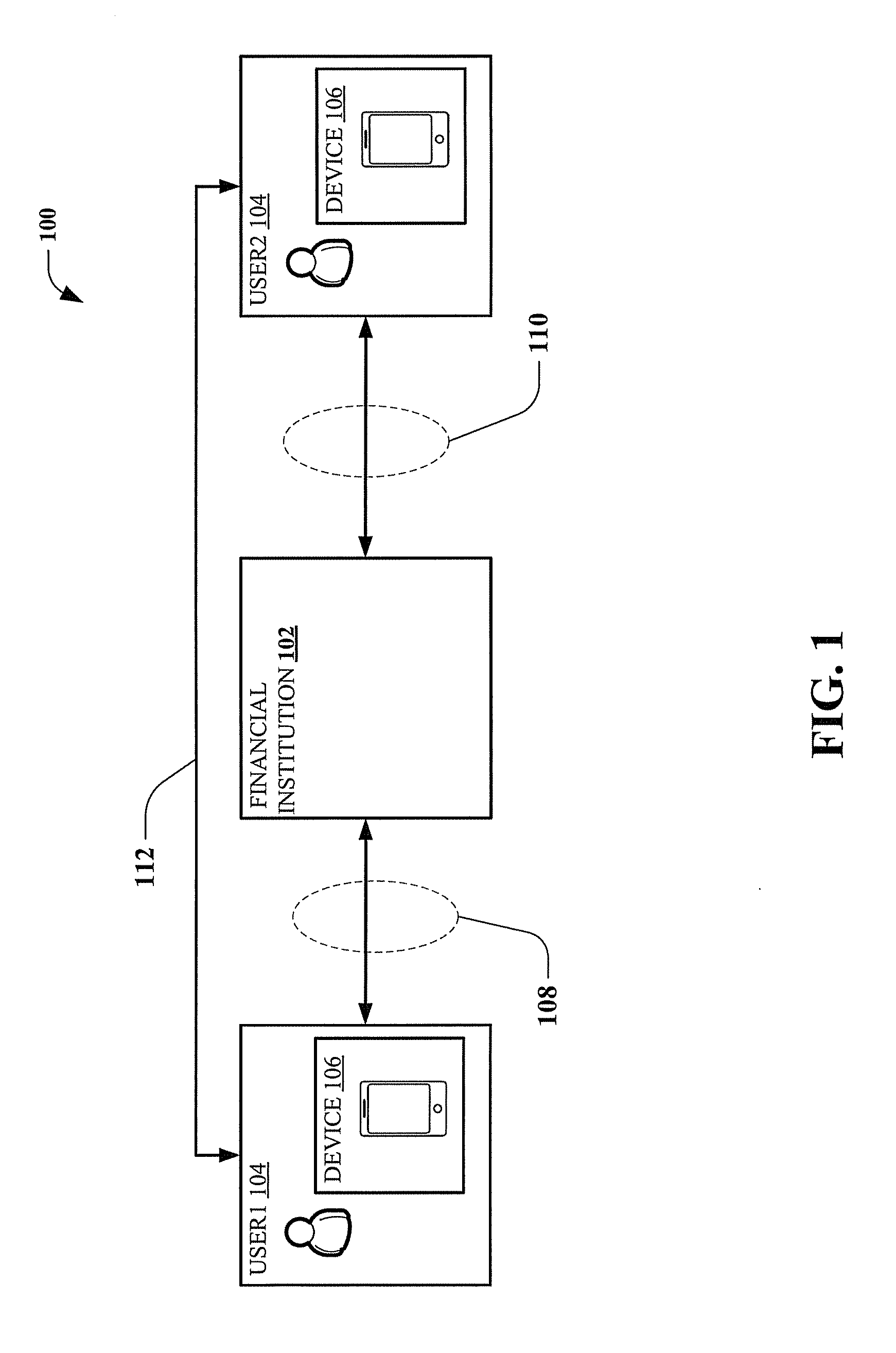

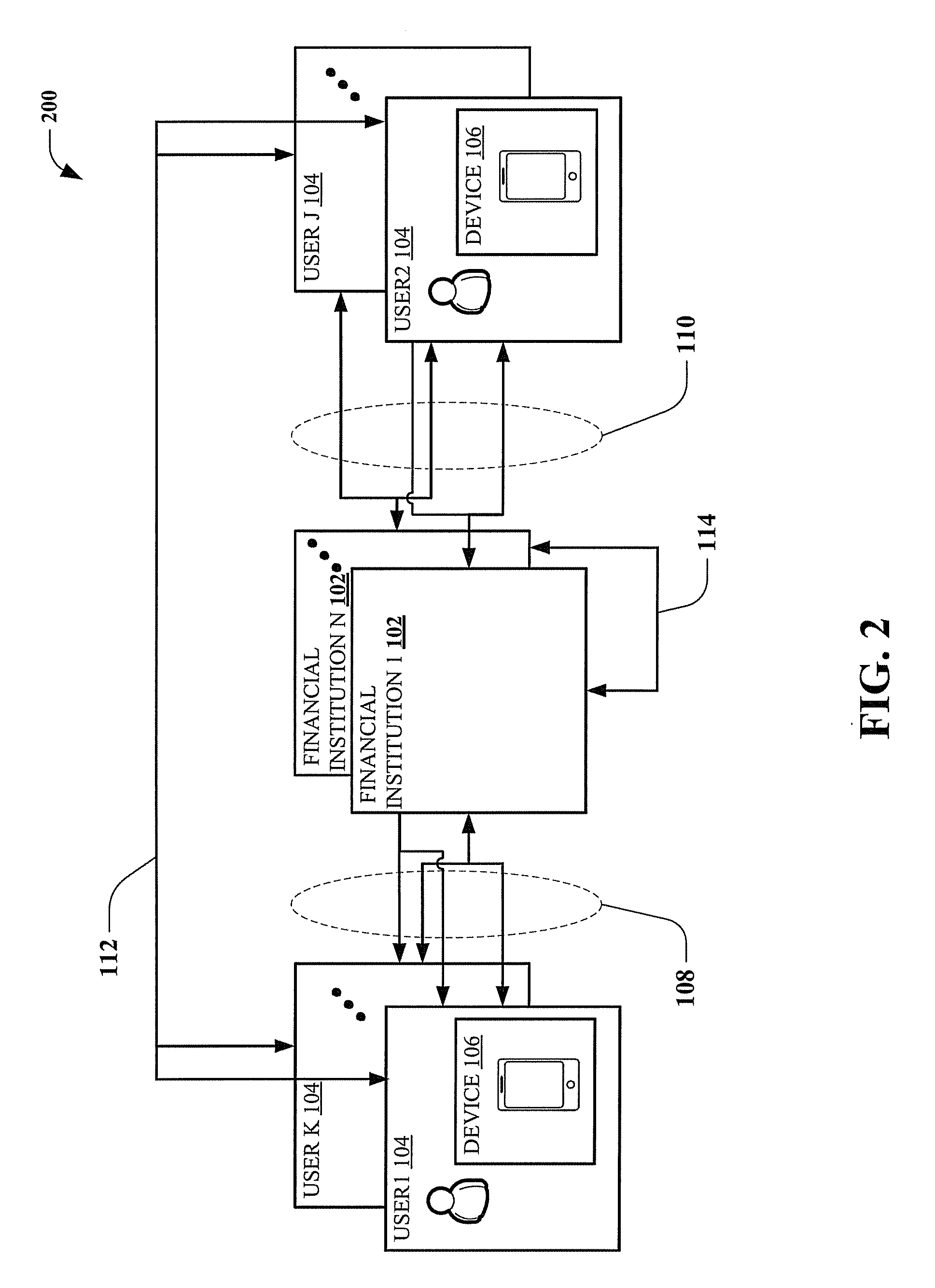

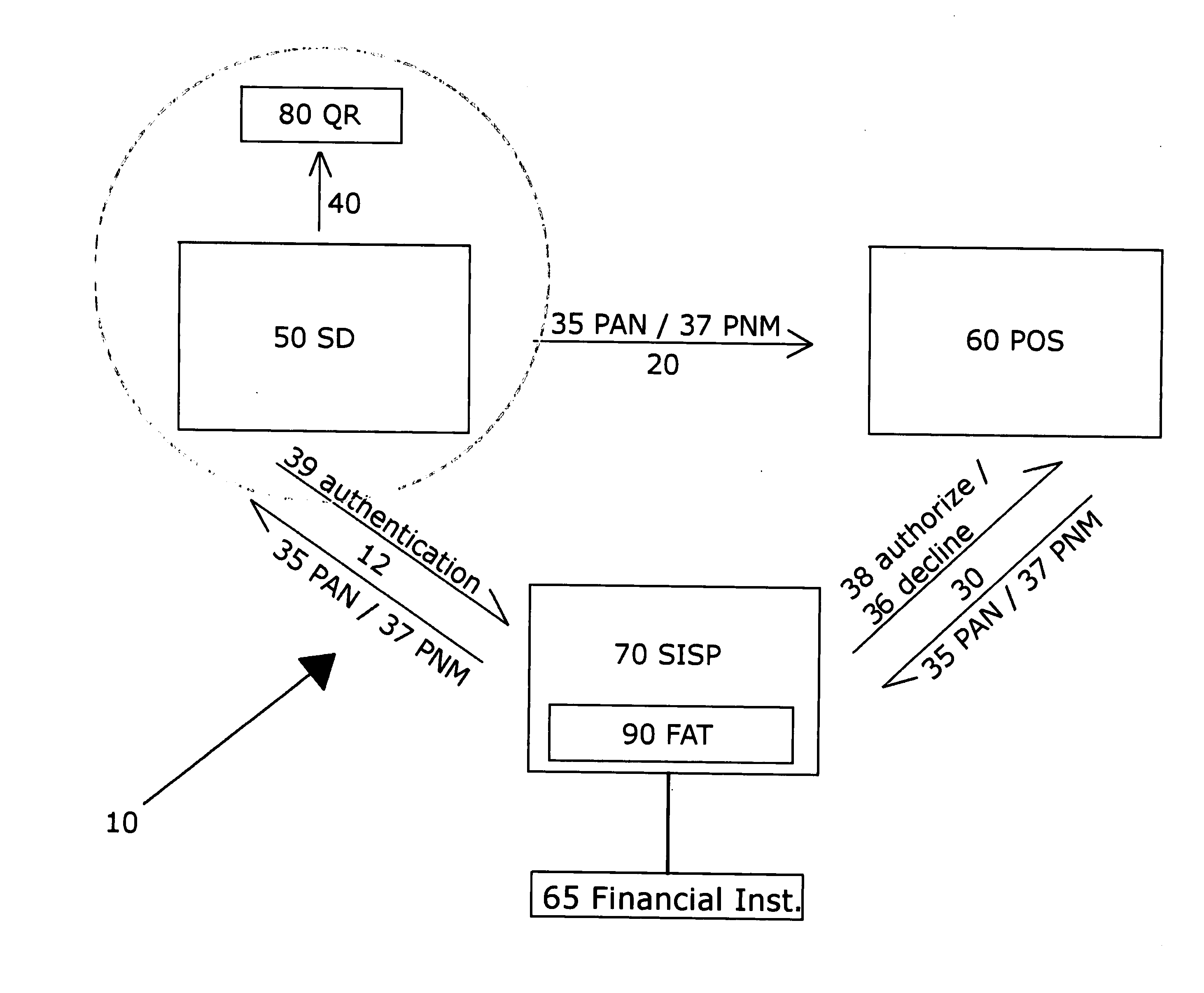

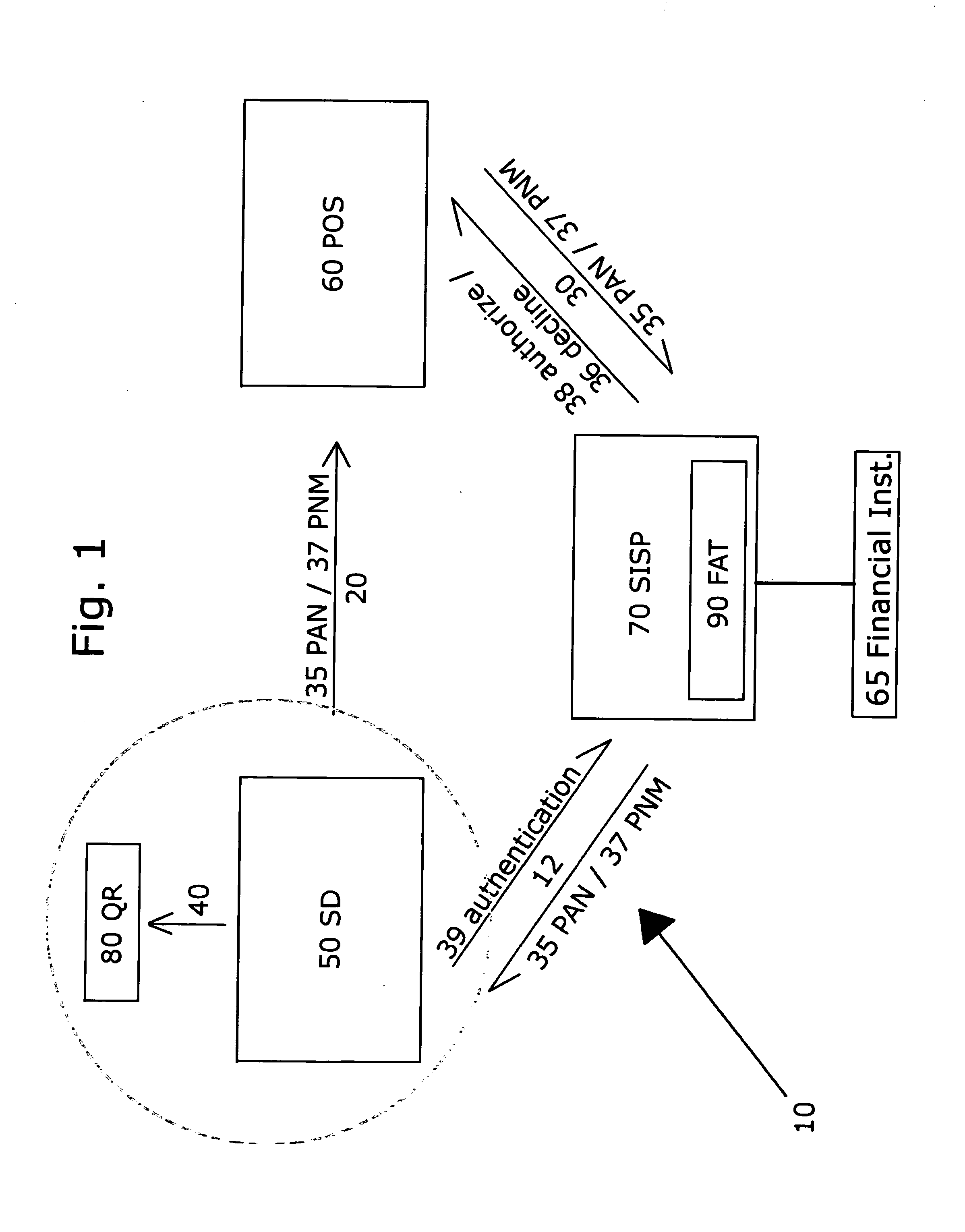

A mobile payment platform and service provides a fast, easy way to make payments by users of mobile devices. The platform also interfaces with nonmobile channels and devices such as e-mail, instant messenger, and Web. In an implementation, funds are accessed from an account holder's mobile device such as a mobile phone or a personal digital assistant to make or receive payments. Financial transactions can be conducted on a person-to-person (P2P) or person-to-merchant (P2M) basis where each party is identified by a unique indicator such as a telephone number or bar code. Transactions can be requested through any number of means including SMS messaging, Web, e-mail, instant messenger, a mobile client application, an instant messaging plug-in application or “widget.” The mobile client application, resident on the mobile device, simplifies access and performing financial transactions in a fast, secure manner.

Owner:OBOPAY MOBILE TECH INDIA PTE LTD

Systems and methods for mobile and online payment systems for purchases related to mobile and online promotions or offers provided using impressions tracking and analysis, location information, 2d and 3D mapping, mobile mapping, social media, and user behavior and information for generating mobile and internet posted promotions or offers for, and/or sales of, products and/or services in a social network, online or via a mobile device

A method, apparatus, computer readable medium, computer system, network, or system is provided for mobile and online payment systems for mobile and online promotions or offers or daily deal coupons or daily deal coupons aggregation provided using impressions tracking and analysis, location information, 2D and 3D mapping, social media, and user behavior and information for generating mobile and internet posted promotions or offers or daily deal coupons or daily deal coupons aggregation for, and / or sales of, products and / or services in a social network, online or via a mobile device-for mobile and web based promotions or offers that connect information and user behavior data to a user or related demographic location or user specified or predicted demographic location(s) for targeted promotions or offers for products and / or services in a social network, online or via a mobile device.

Owner:HEATH STEPHAN

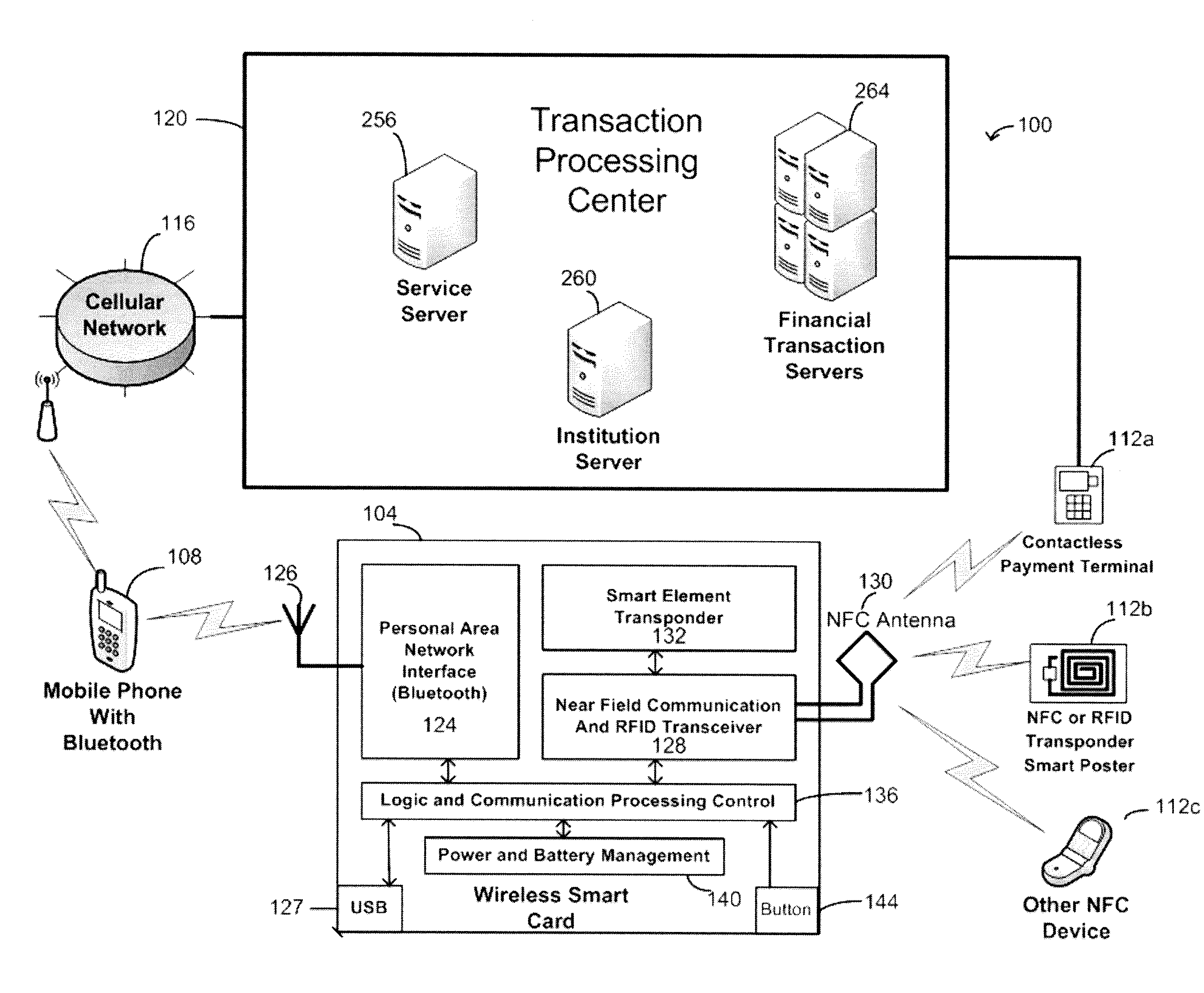

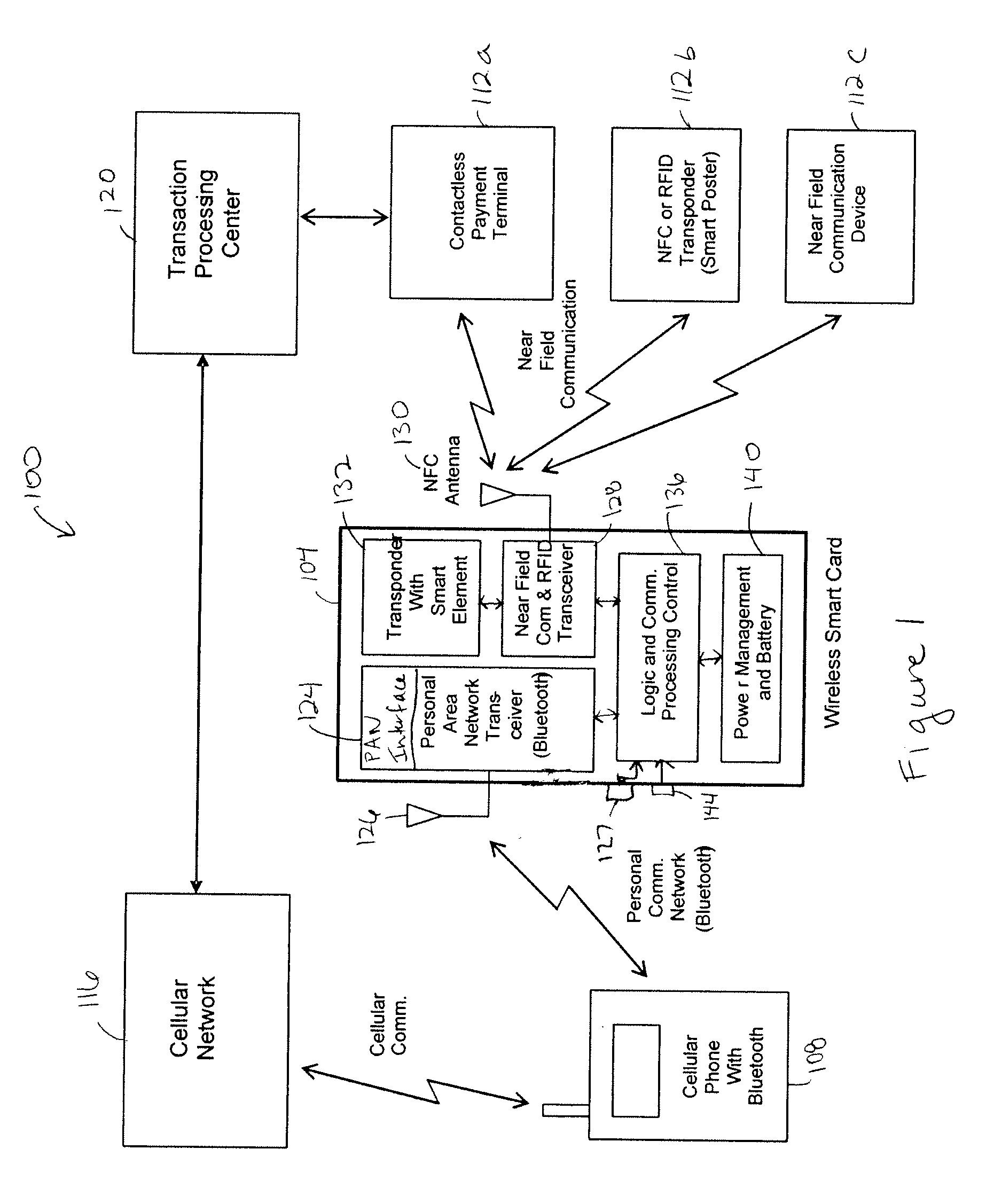

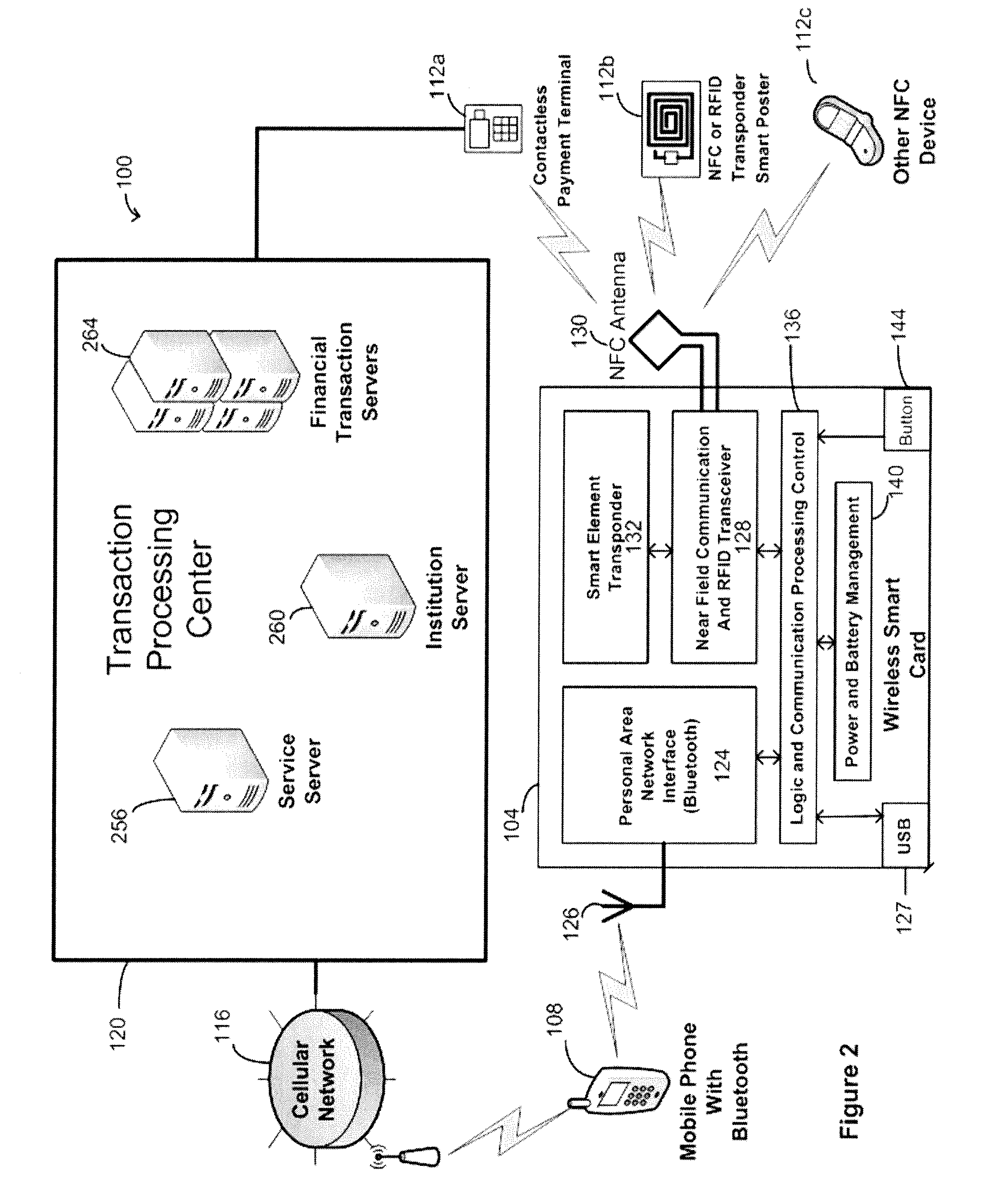

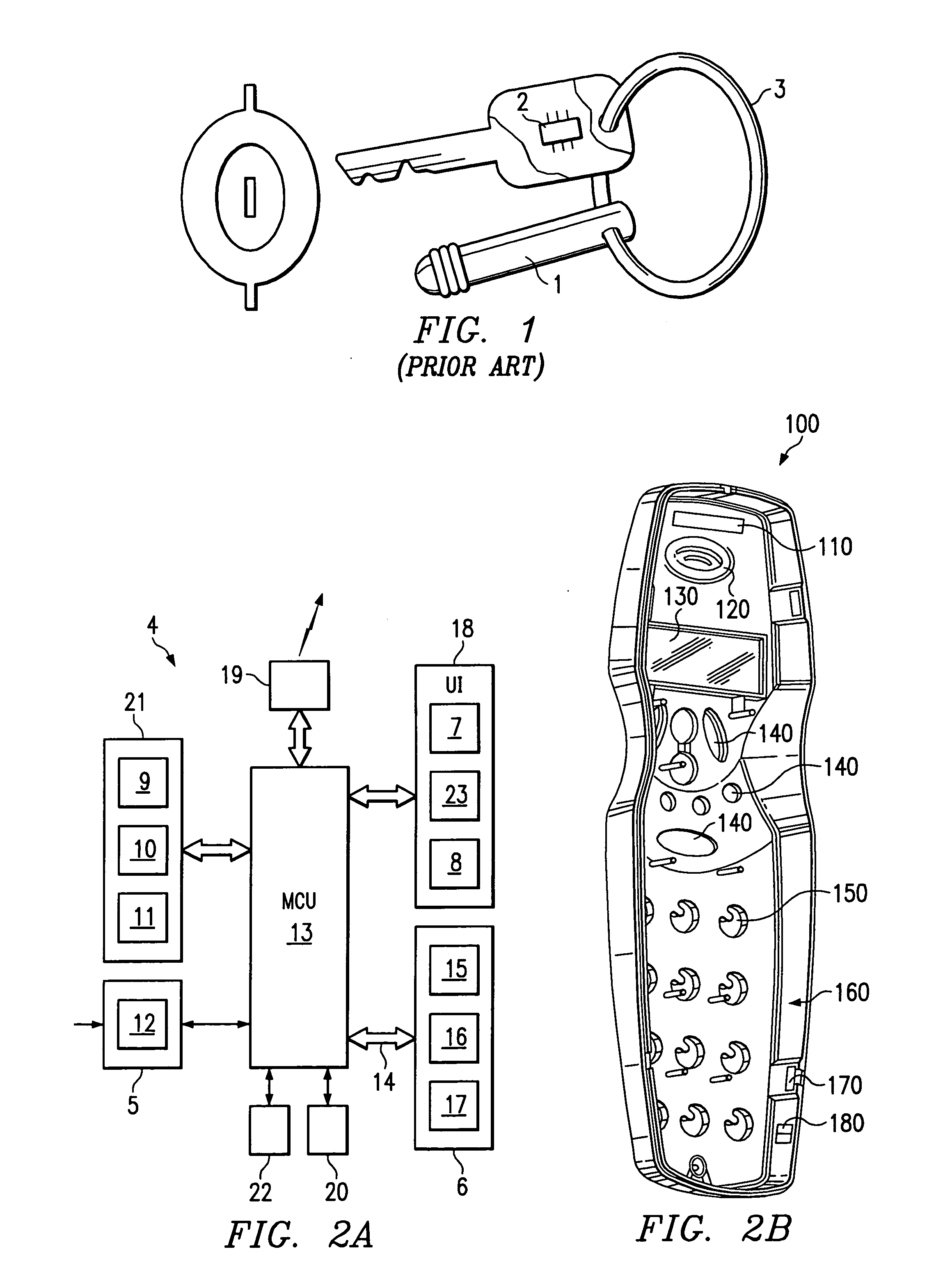

Wireless smart card and integrated personal area network, near field communication and contactless payment system

A wireless smart card having a personal area network transceiver, such as a Bluetooth transceiver, to couple the wireless smart card with a mobile communication device, and a near field communication (NFC) and radio-frequency identification (RFID) transceiver to couple the wireless smart card to a wireless transaction device, and a transponder with a secure element to allow secure communications between the mobile communication device with the wireless smart card and the wireless smart card and the wireless transaction device is described. The wireless smart card allows, for example, contactless payment through a Bluetooth-enabled mobile communication device without modification to the mobile communication device.

Owner:WIRELESS DYNAMICS

System and method of facilitating contactless payment transactions across different payment systems using a common mobile device acting as a stored value device

InactiveUS20050222961A1Convenient transactionSubstation equipmentCurrency conversionPayment transactionData exchange

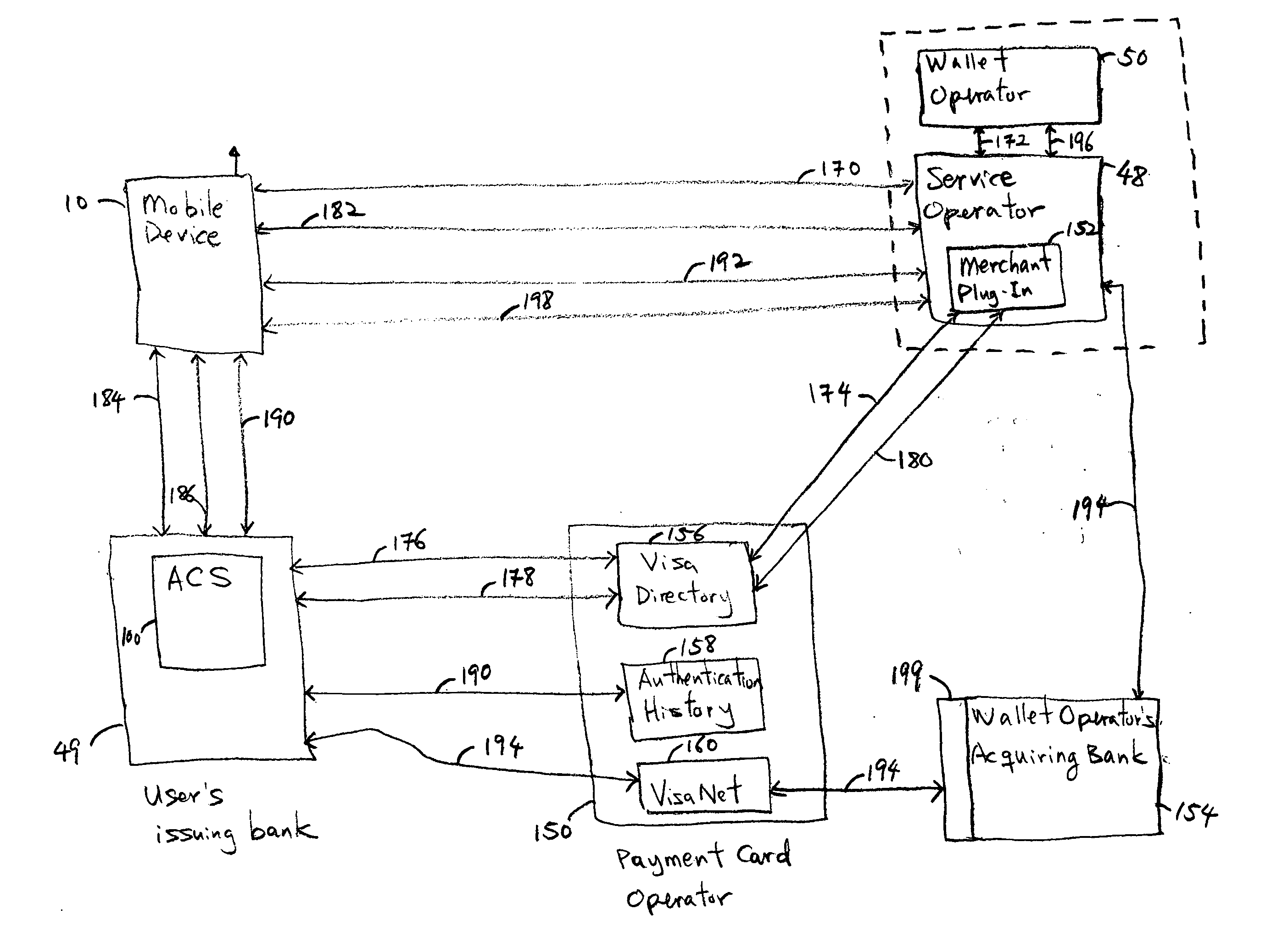

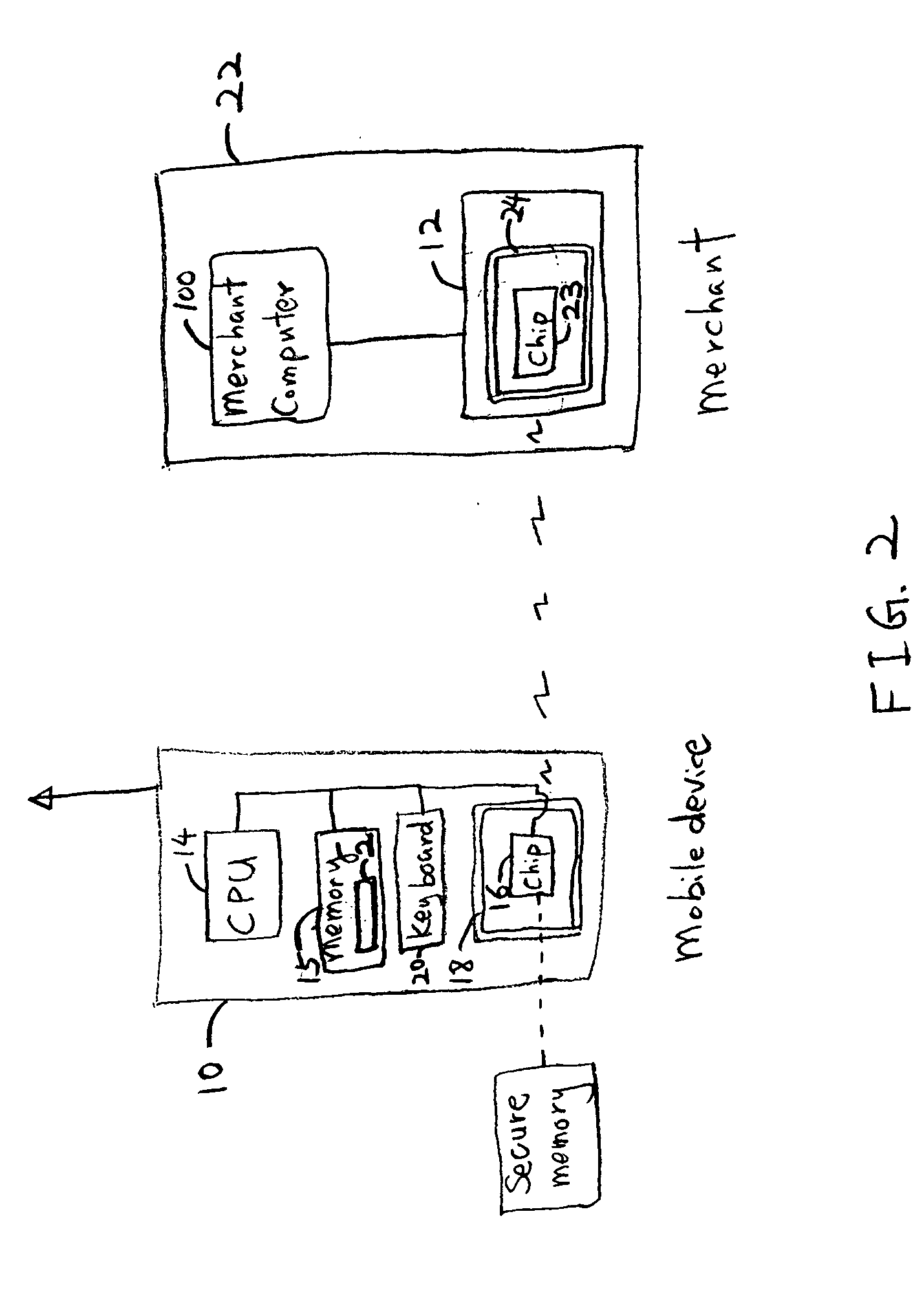

A system for facilitating contactless payment transactions across different contactless payment systems using a common mobile device that acts as a stored value device is provided. A combination of a mobile application and a communication module allows the mobile device, which is associated with one payment system, to emulate various transmission standards and data exchange formats that are used in different payment systems in order to perform contactless payment transactions with merchants that are associated with different contactless payment systems. A service application running in a service operator computer communicates with the various contactless payment systems to facilitate the settlement of the amount owed to various payment systems by the one payment system associated with the mobile device.

Owner:PAYZY CORP

Mobile Person-to-Person Payment System

InactiveUS20070255652A1The process is simple and fastSimple accessFinancePayment architectureBarcodeFinancial transaction

A mobile payment platform and service provides a fast, easy way to make payments by users of mobile devices. The platform also interfaces with nonmobile channels and devices such as e-mail, instant messenger, and Web. In an implementation, funds are accessed from an account holder's mobile device such as a mobile phone or a personal digital assistant to make or receive payments. Financial transactions may be conducted on a person-to-person (P2P) or person-to-merchant (P2M) basis where each party is identified by a unique indicator such as a telephone number or bar code. Transactions may be requested through any number of means including SMS messaging, Web, e-mail, instant messenger, a mobile client application, an instant messaging plug-in application or “widget.” The mobile client application, resident on the mobile device, simplifies access and performing financial transactions in a fast, secure manner.

Owner:OBOPAY MOBILE TECH INDIA PTE LTD

Transacting Mobile Person-to-Person Payments

InactiveUS20070255620A1The process is simple and fastSimplifies access and performing financial transactionFinancePayment architectureTelecommunicationsMobile payment

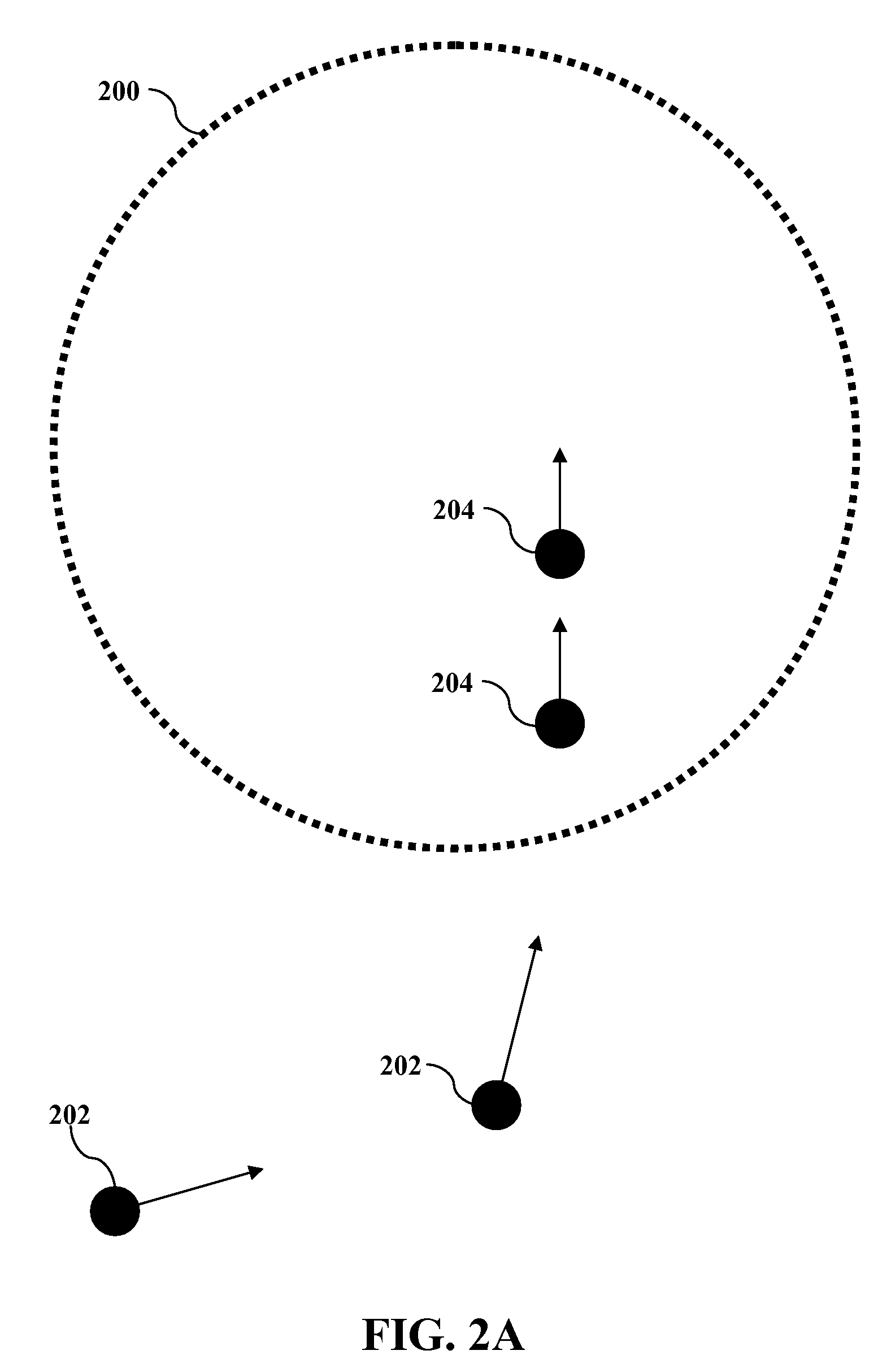

In a mobile payment system, registered users or members may send payment to other member or unregistered users or nonmembers. In a specific implementation, a person-to-person payment system allows existing members of a payment system to send funds to nonmembers with the intent that the nonmember becomes a member. This ability of a payment system may be referred to as “viral” because it promotes new member registrations in an exponential spreading fashion.

Owner:OBOPAY INC

Transaction system

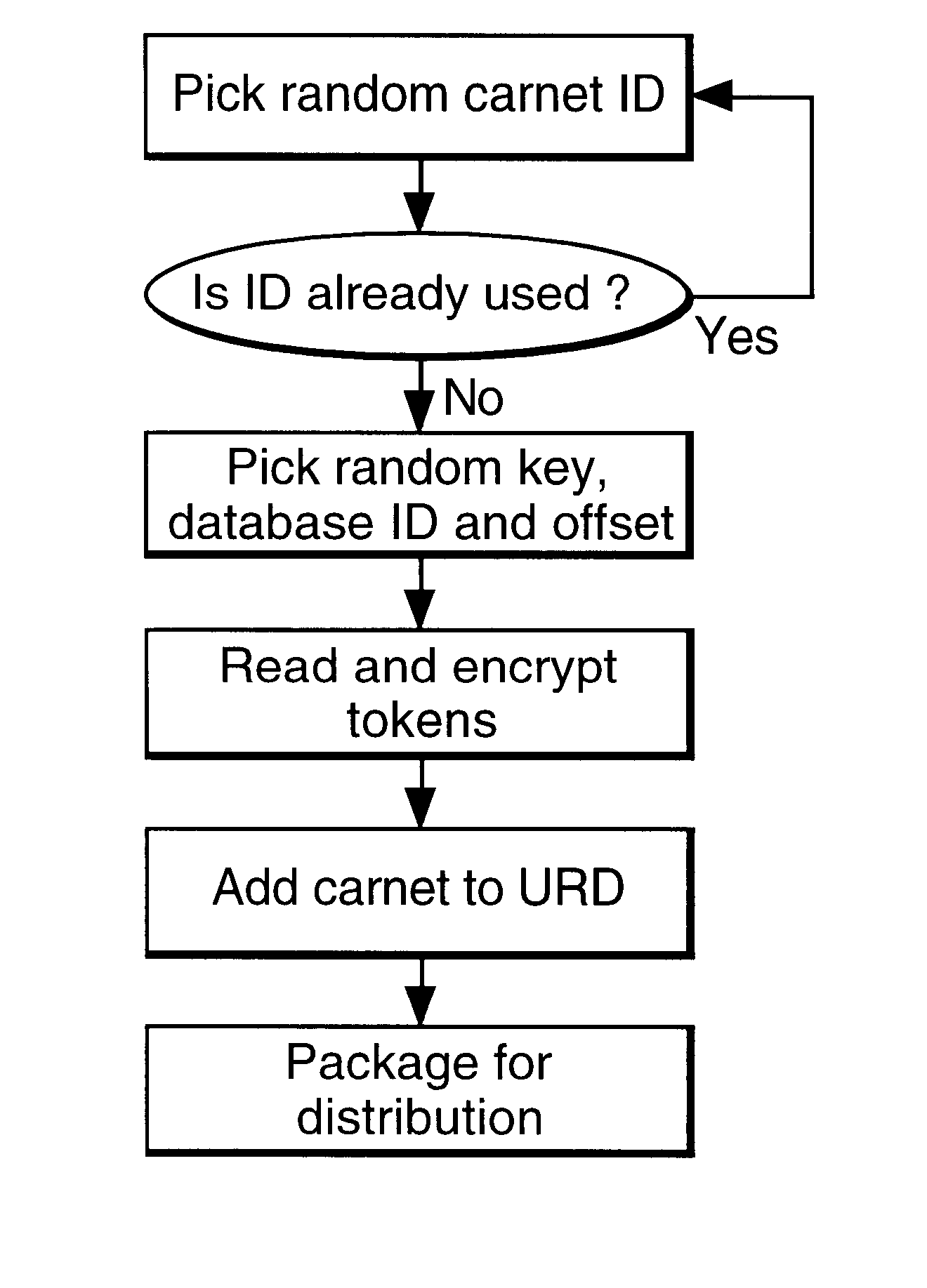

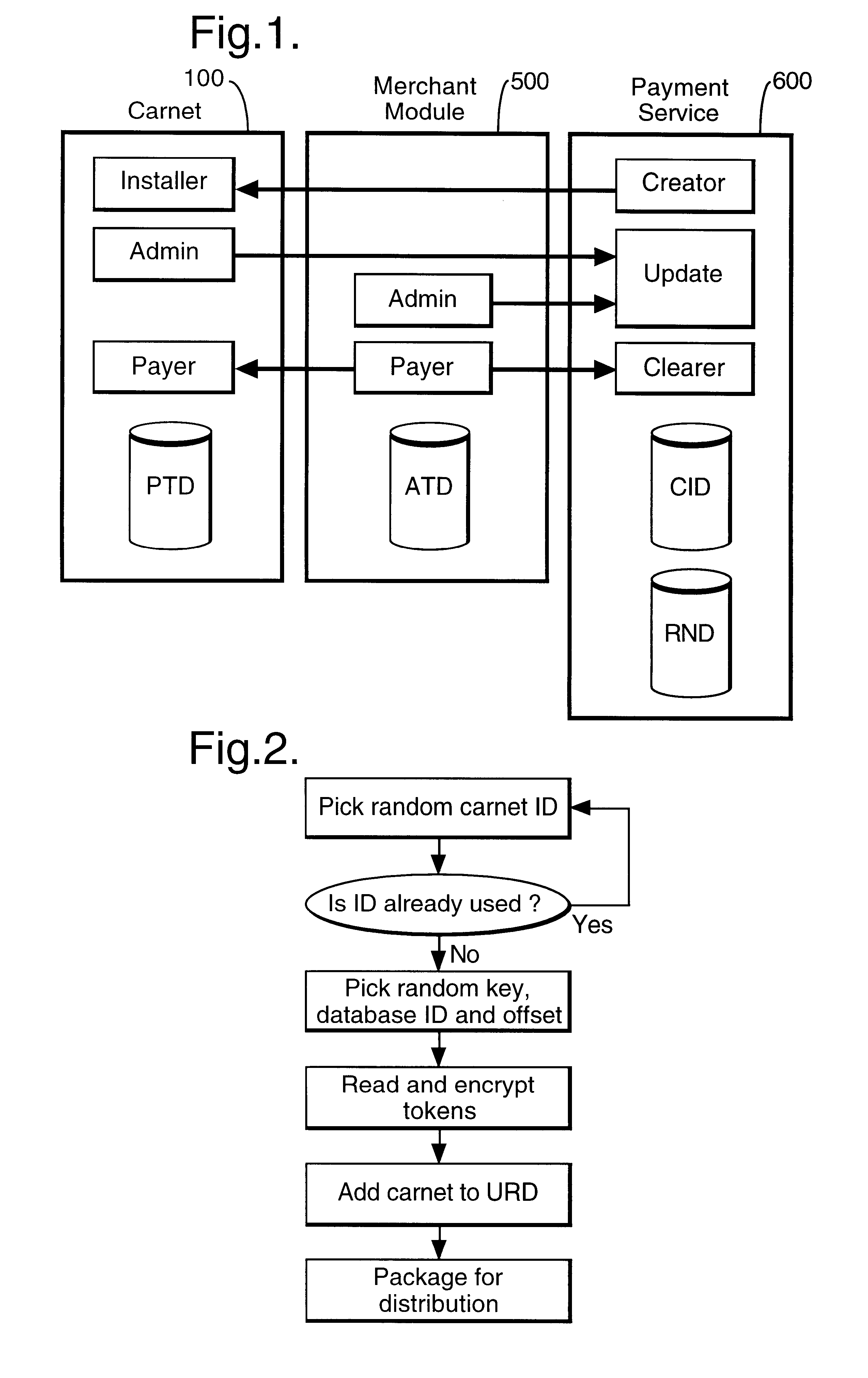

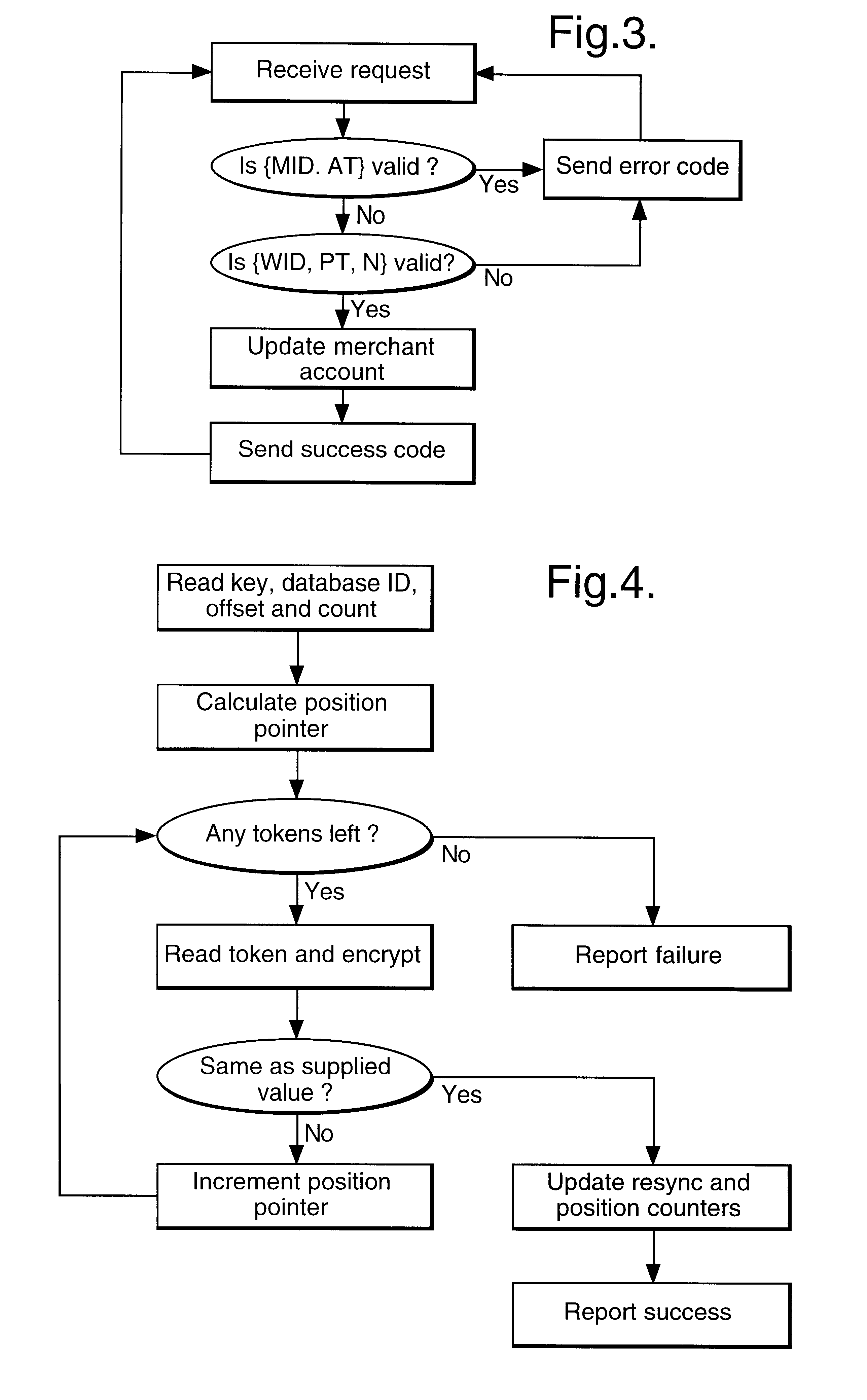

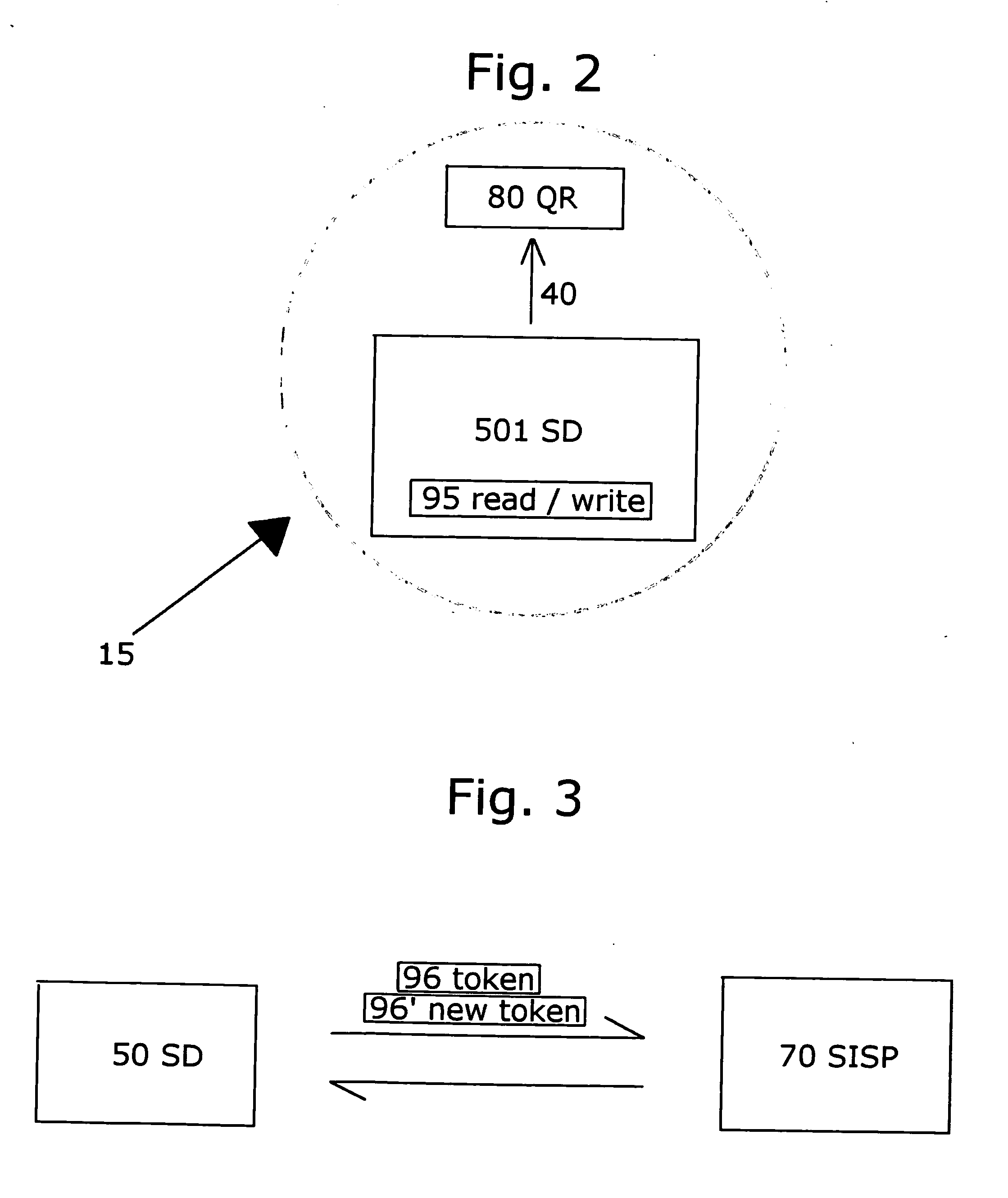

InactiveUS6236981B1Improve securityImprove the level ofUser identity/authority verificationComputer security arrangementsService provisionThe Internet

In a digital payment system, a sequence of random numbers is stored at a payment service. A set of digitally encoded random numbers derived from the stored sequence is issued to the user in return for payment. The tokens are stored in a Carnet. The user can then spend the tokens by transferring tokens to a merchant, for example, to an on-line service provider. The merchant returns each token received to the payment server. The payment server authenticates the token and transmits an authentication message to the merchant. The merchant, payment server and user may be linked by internet connections.

Owner:BRITISH TELECOMM PLC

Member-Supported Mobile Payment System

InactiveUS20070233615A1Facilitates manualFacilitates automated load functionalityFinancePayment architectureWireless handheld devicesMobile payment

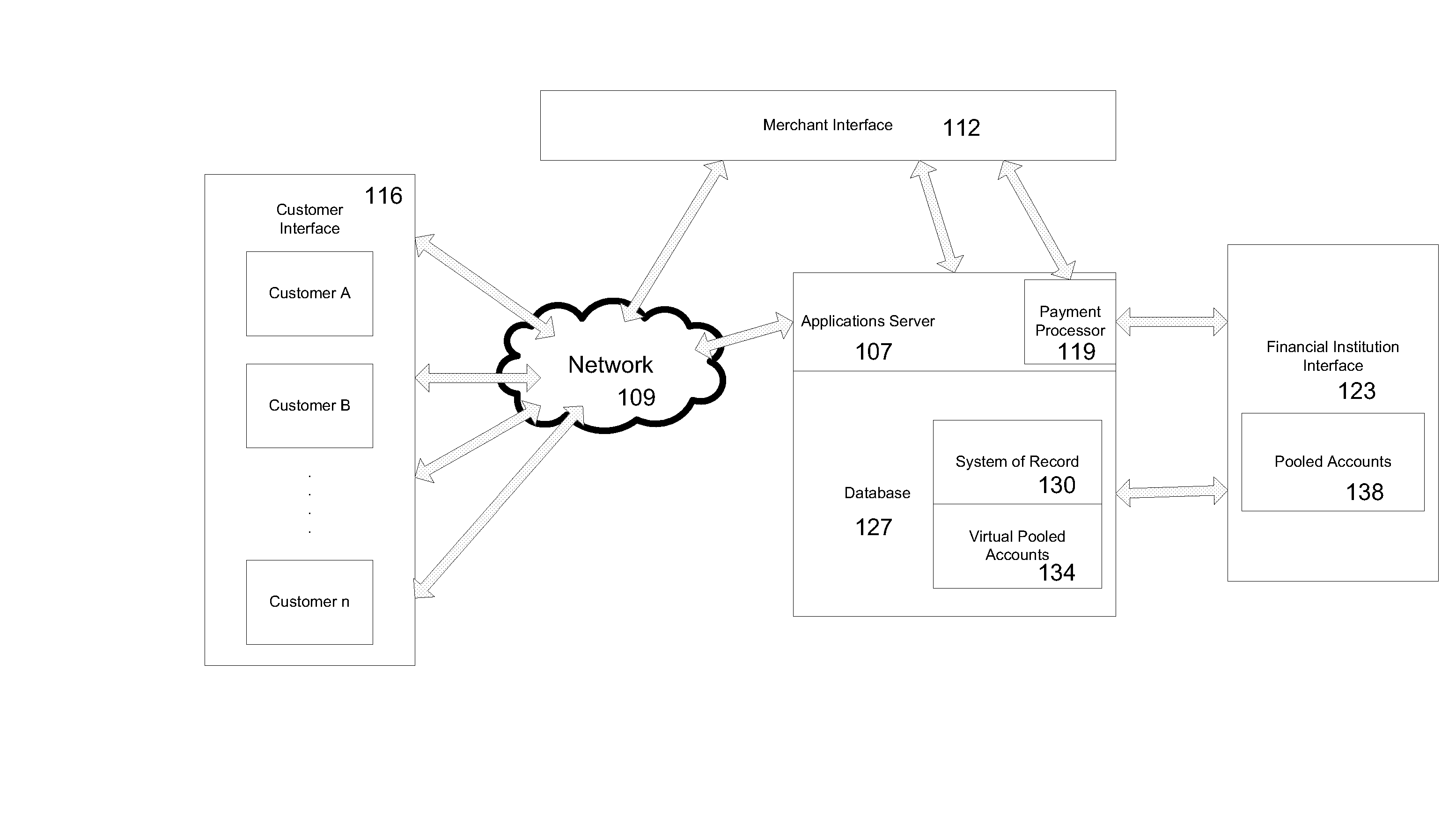

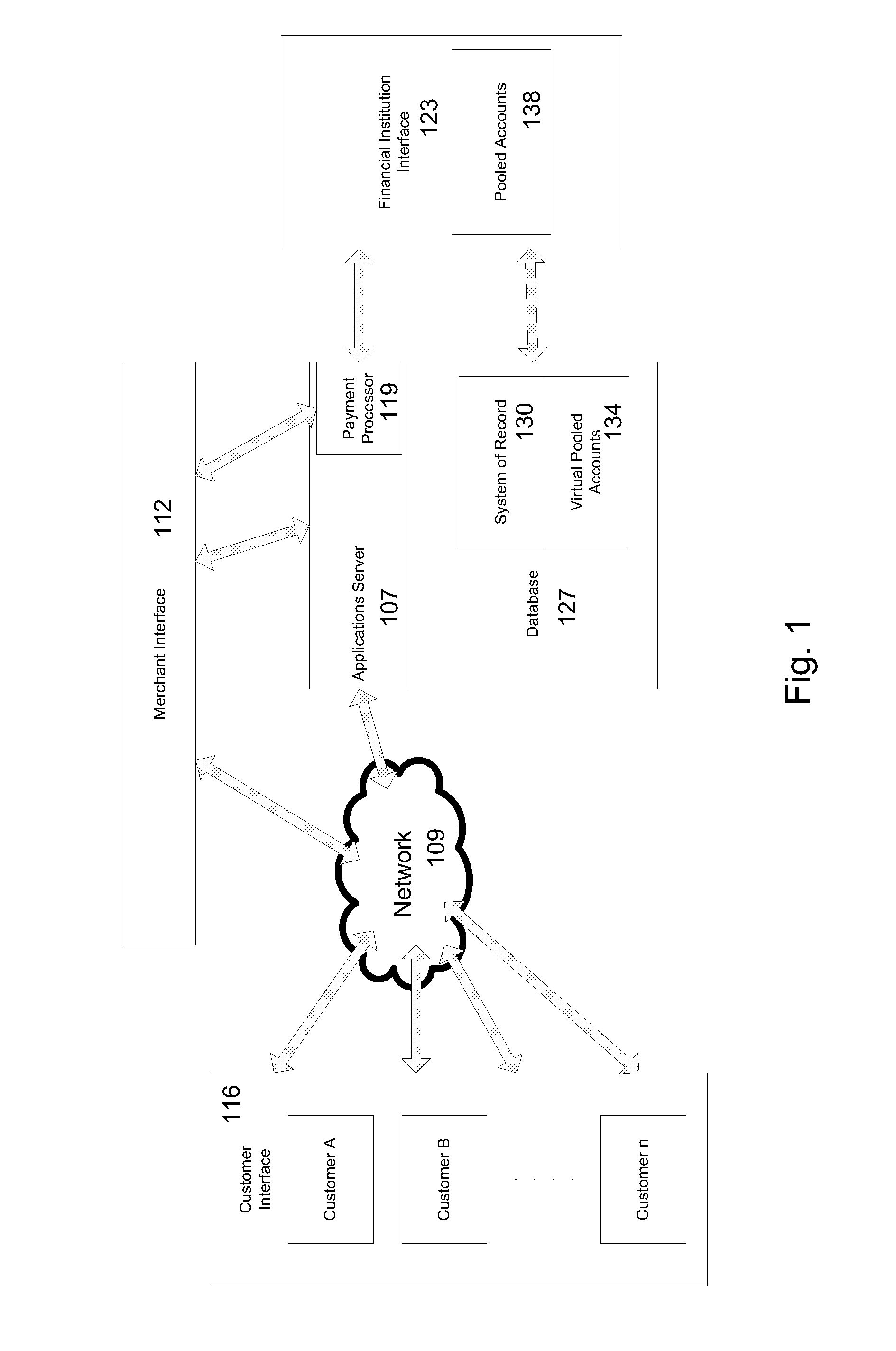

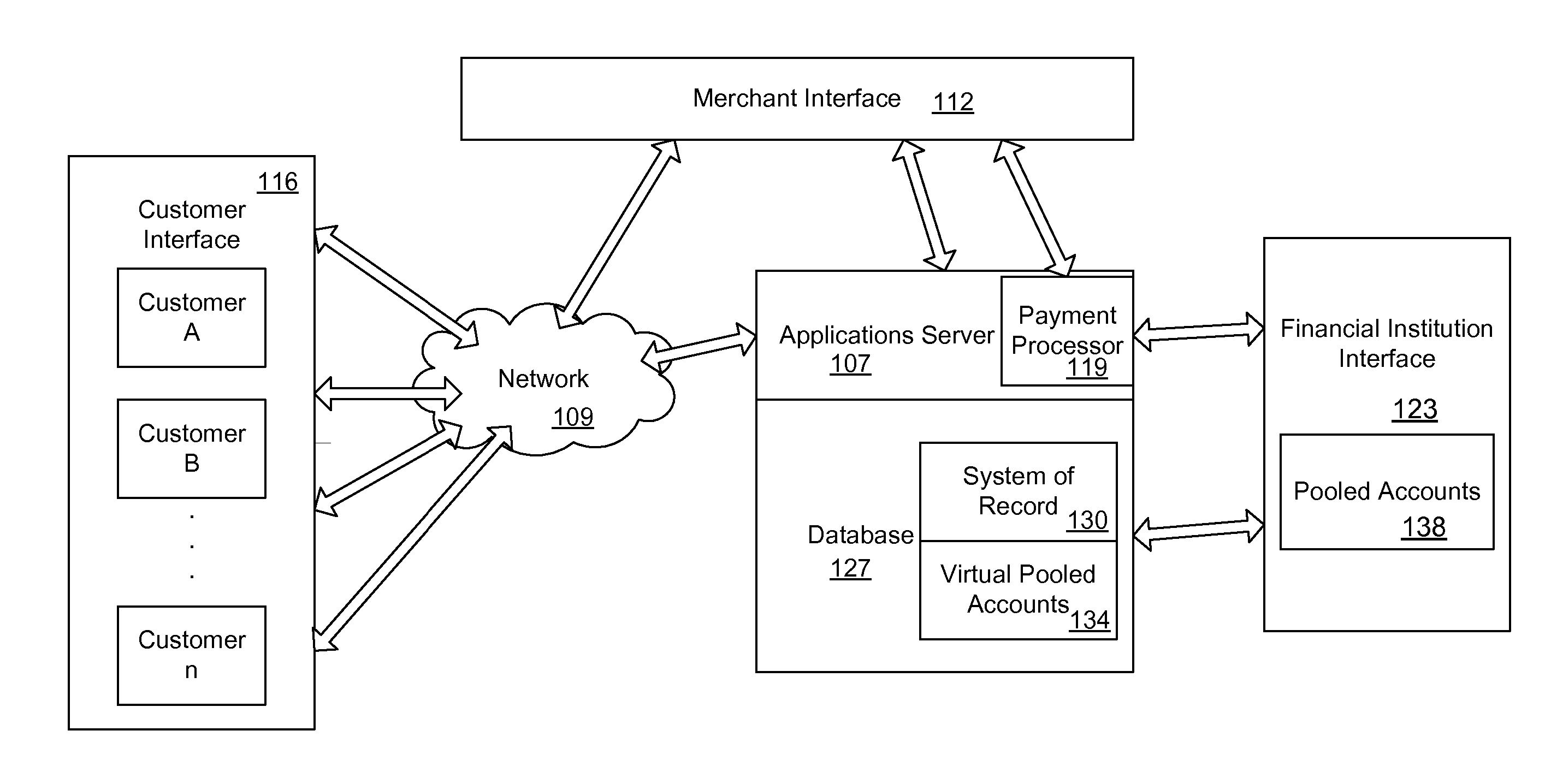

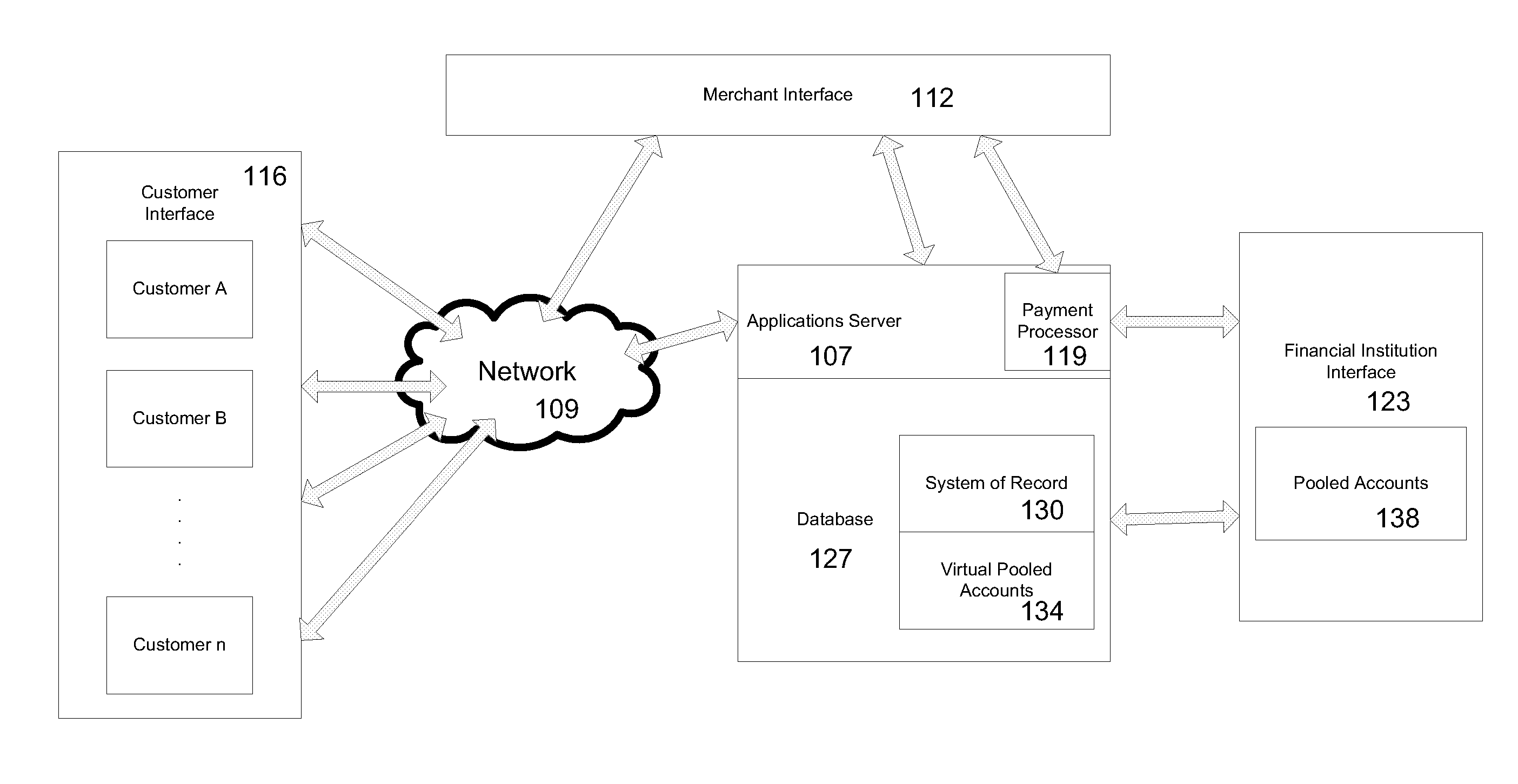

A member-supported payment system is available to consumers and merchants without sign-up fees, subscription fees, or transaction fees to either consumers or merchants. In a specific implementation, the member payment system is a mobile payment system where consumers may conduct transactions using a mobile device such as a mobile telephone, smartphone, personal digital assistant, or similar portable wireless handheld device. Merchants will make a refundable one-time contribution. These contributions are stored in a pooled trust account by the system and the float dividends or interest on these contributions will fund the system.

Owner:OBOPAY MOBILE TECH INDIA PTE LTD

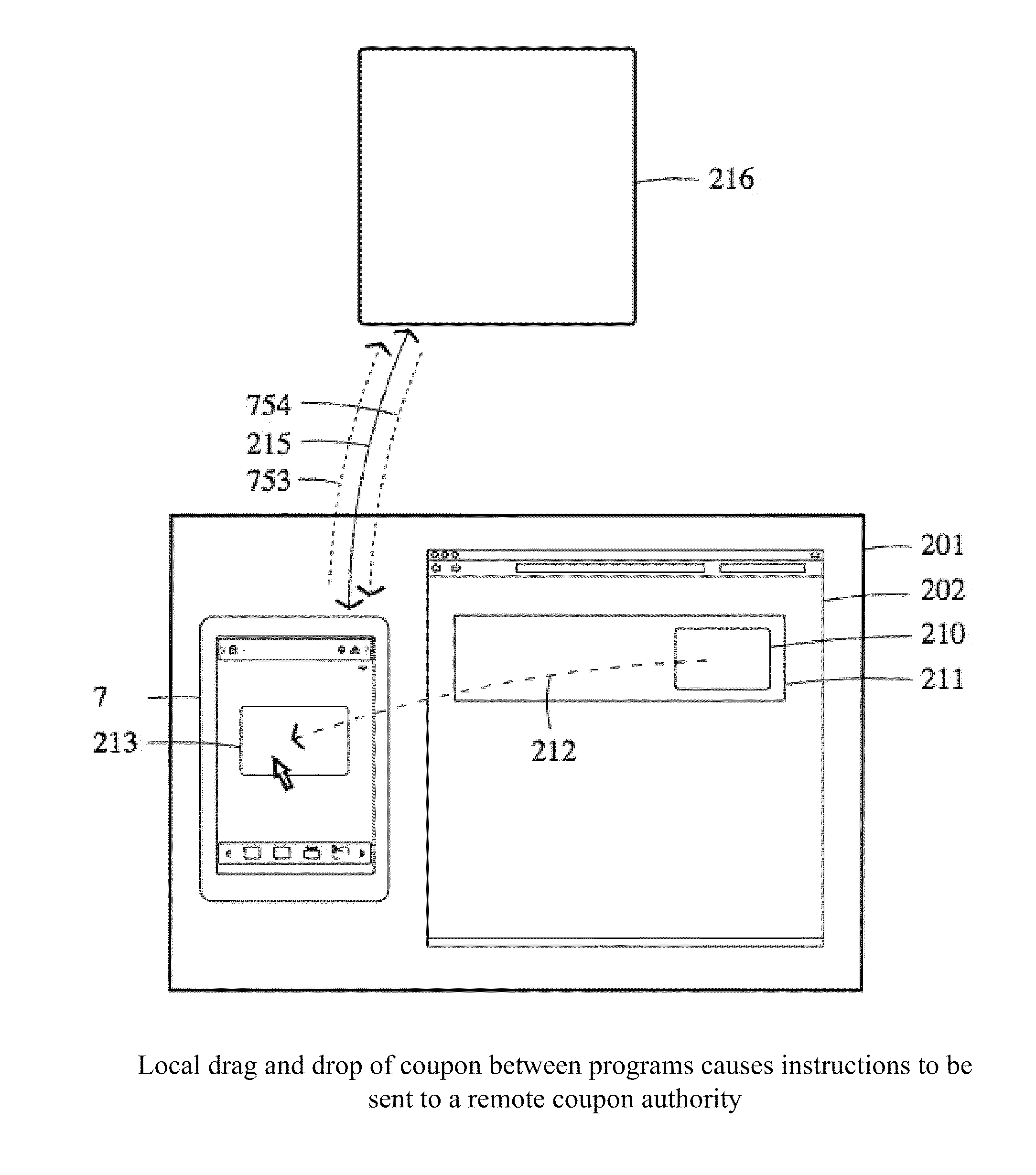

Dispensing digital objects to an electronic wallet

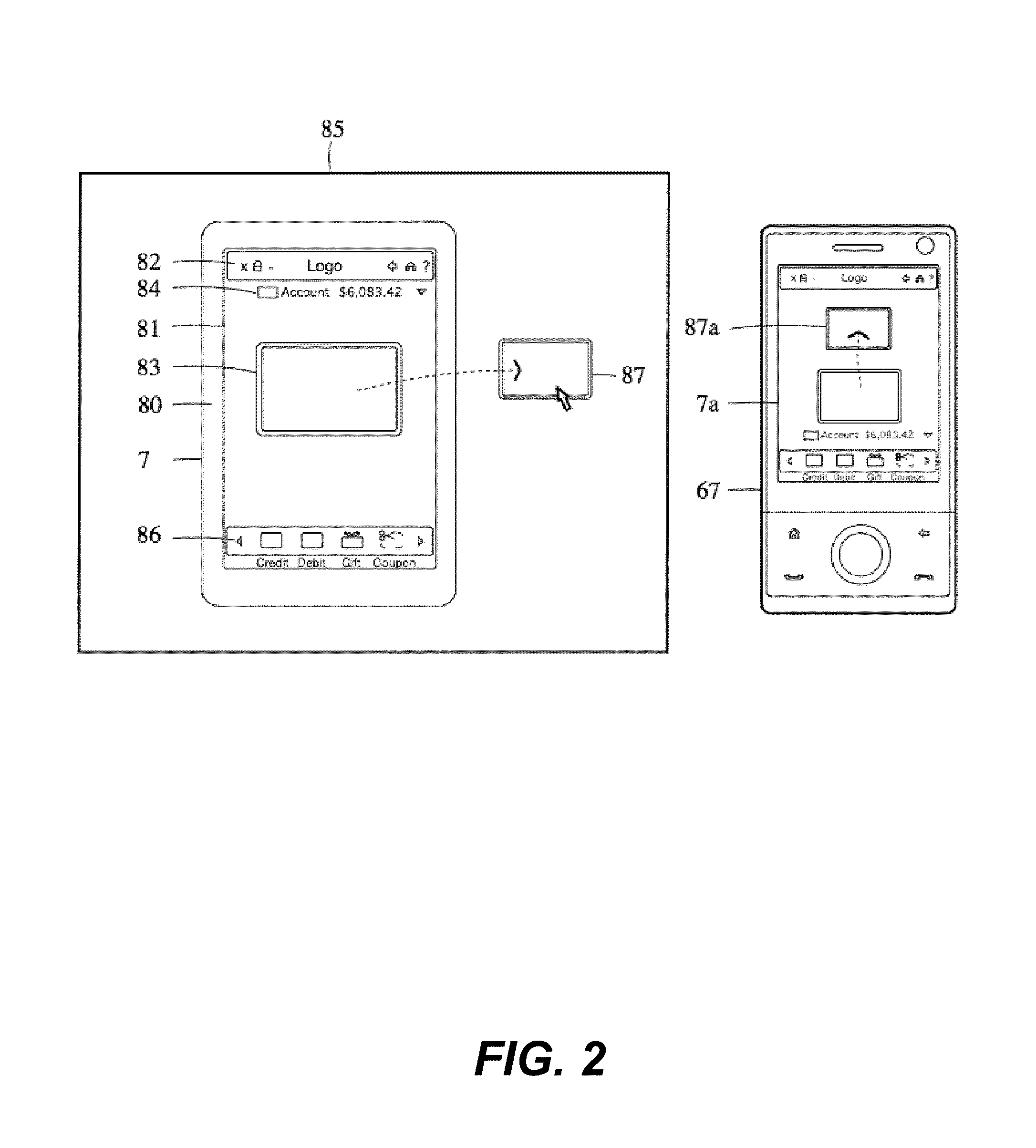

A configuration system and method is disclosed that includes a unified and integrated configuration that is composed of a payment system, an advertising system, and an identity management system such that the unified system has all of the benefits of the individual systems as well as several additional synergistic benefits. Also described are specific configurations including the system's access point architecture, visual wallet simulator user interface, security architecture, coupon handling as well as the system's structure and means for delivering them as targeted advertising, business card handling, membership card handling for the purposes of login management, receipt handling, and the editors and grammars provided for customizing the different types of objects in the system as well as the creation of new custom objects with custom behaviors. The configurations are operable on-line as well as through physical presence transactions.

Owner:GOOGLE LLC

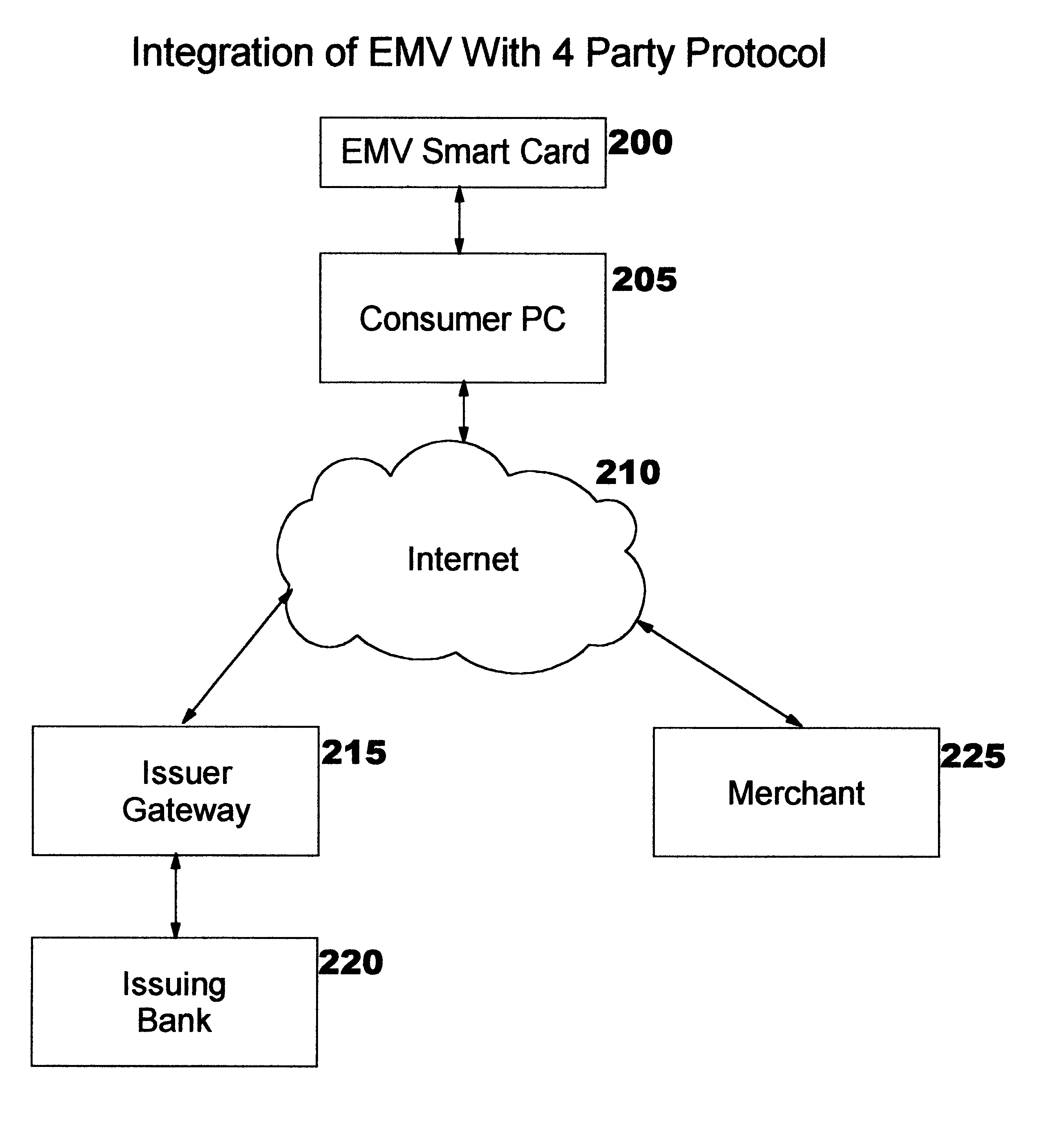

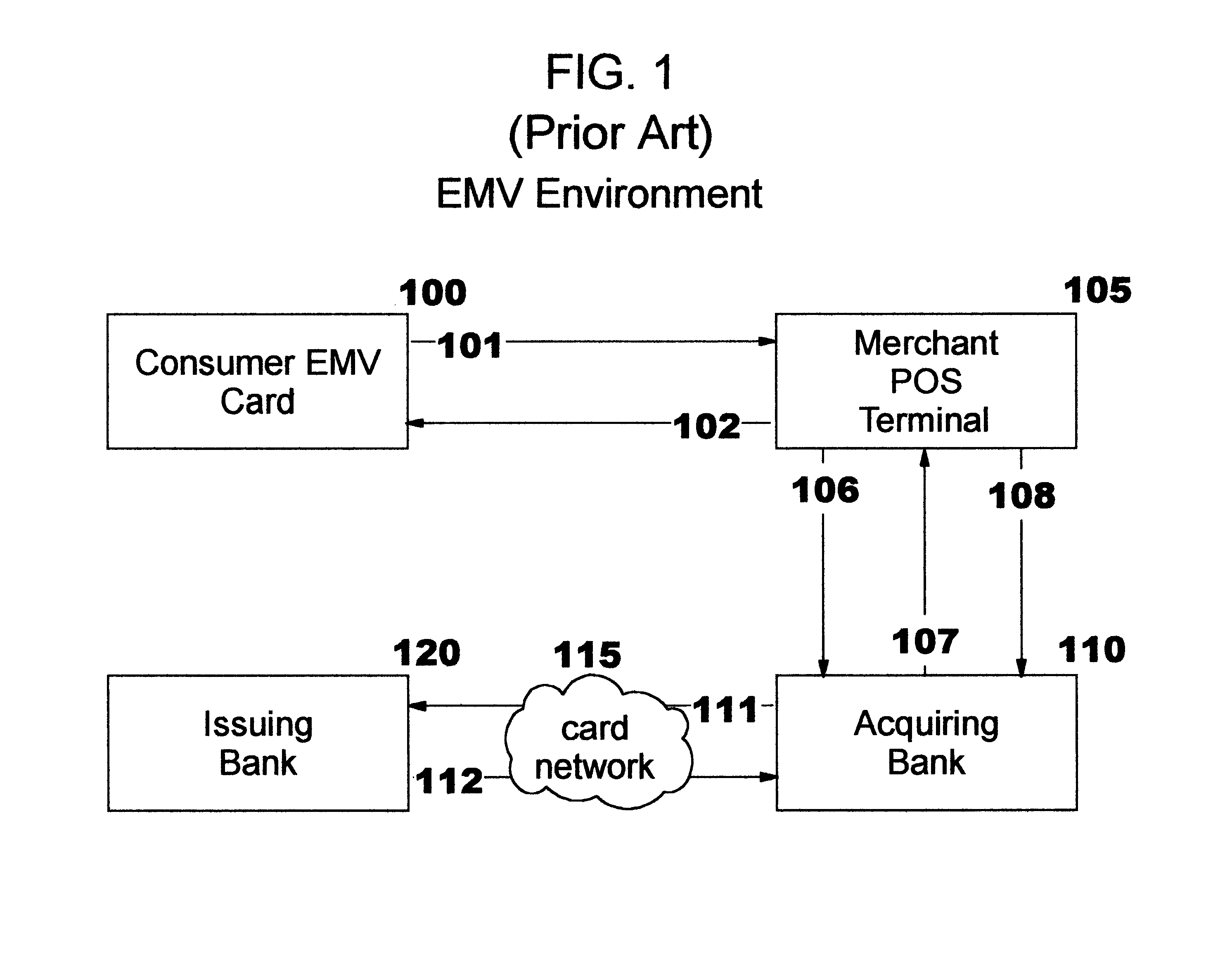

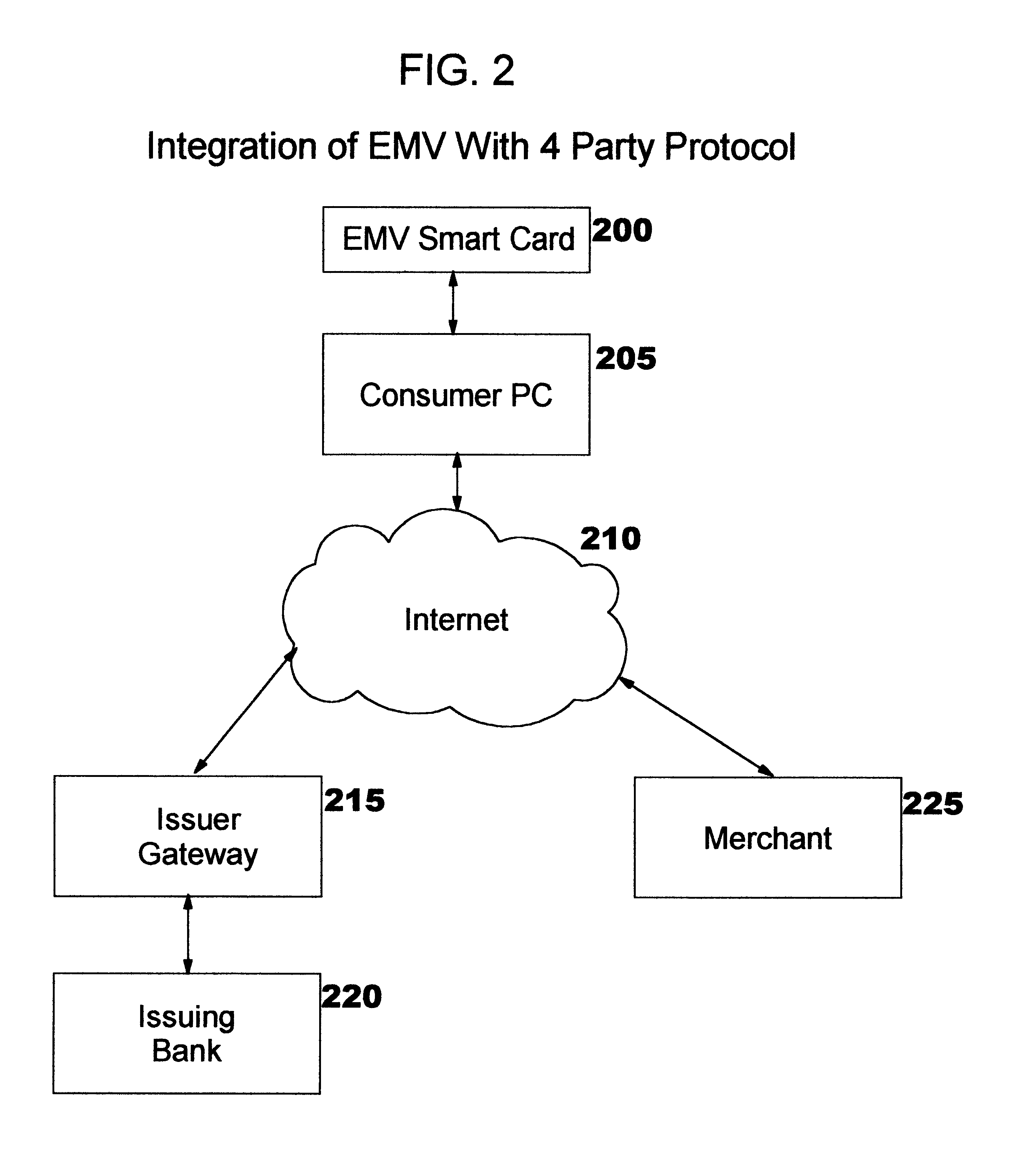

Enabling use of smart cards by consumer devices for internet commerce

A method, system, and computer readable code for enabling use of smart cards by consumer devices for Internet commerce. This is achieved by integrating an existing “Integrated Circuit Card Specification for Application Payment Systems” standard (commonly known as the “EMV” standard) with an augmented version of the Four-Party Credit / Debit Payment Protocol which was disclosed in U.S. Pat. No. 6,327,578. The result of the integration allows a consumer to use a smart card from a personal computer system for credit or debit transactions, while preserving the level of security and other features required by the credit card associations and banks. No modifications are required to the existing EMV standard or existing EMV smart cards.

Owner:IBM CORP

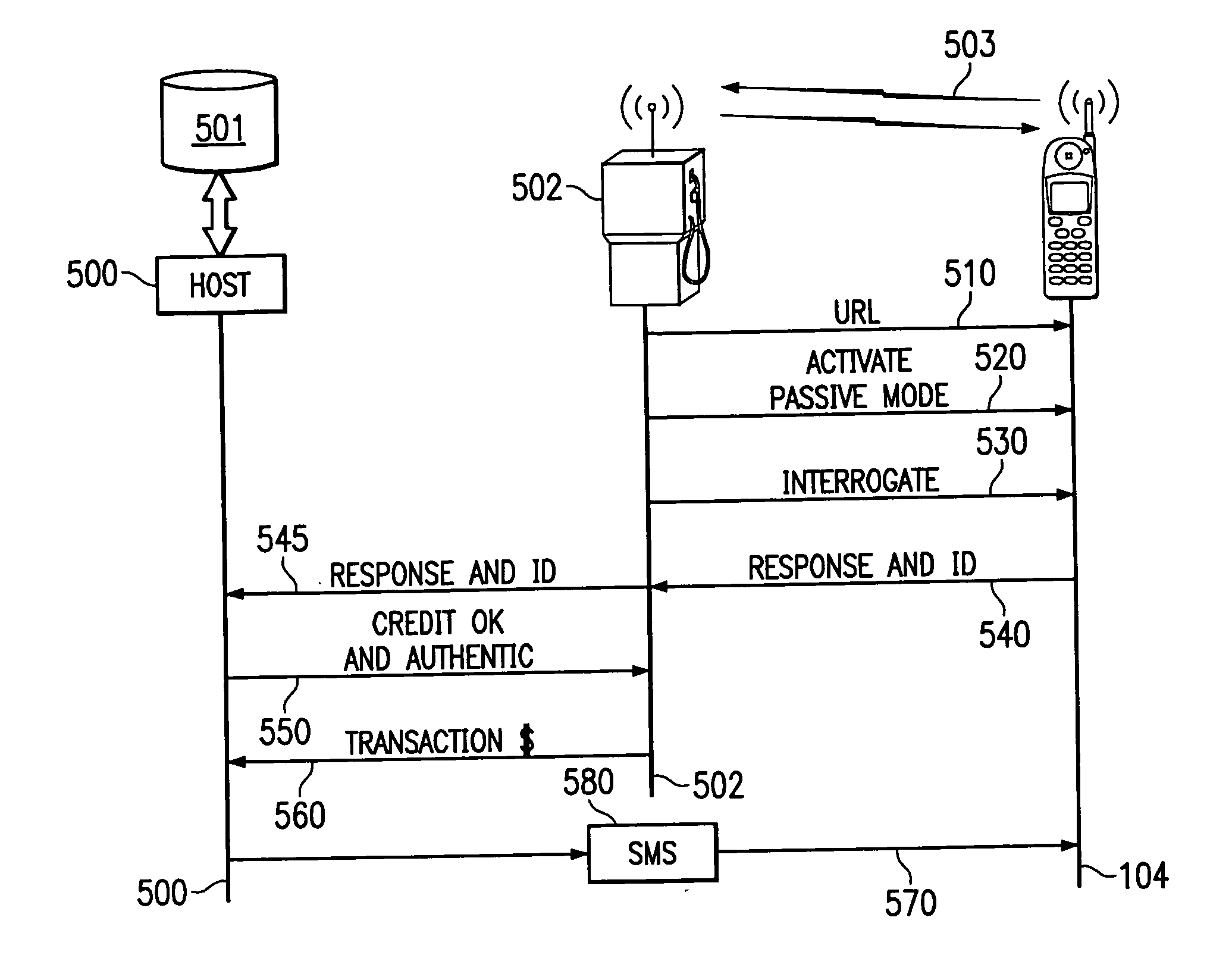

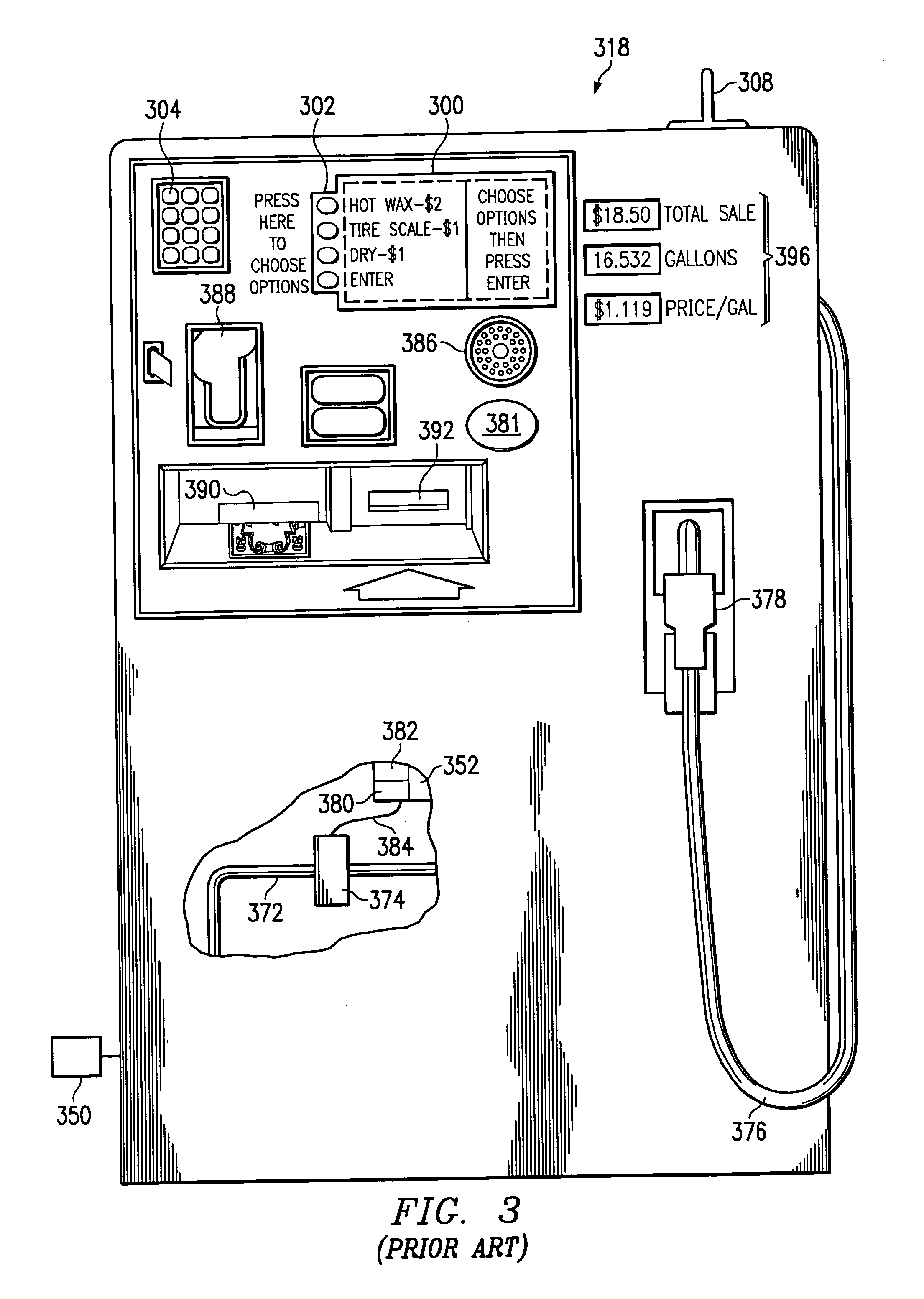

System and method of making payments using an electronic device cover with embedded transponder

InactiveUS20050017068A1Improve standardsDevices with card reading facilityCash registersTransceiverElectronic identification

A changeable cover for an electronic device and method of using same in a payment system is provided. The cover has a transponder responsive to interrogation by an electric field. The cover provides an electronic identification number and other information in response to the interrogation signal. Also provided is a system for making payments, comprising at least one mobile station (4) which has an associated cover (100) for providing local data transfer. The system also comprises at least one point of sale terminal or the like, which has a second transceiver for providing data transfer.

Owner:RPX CORP

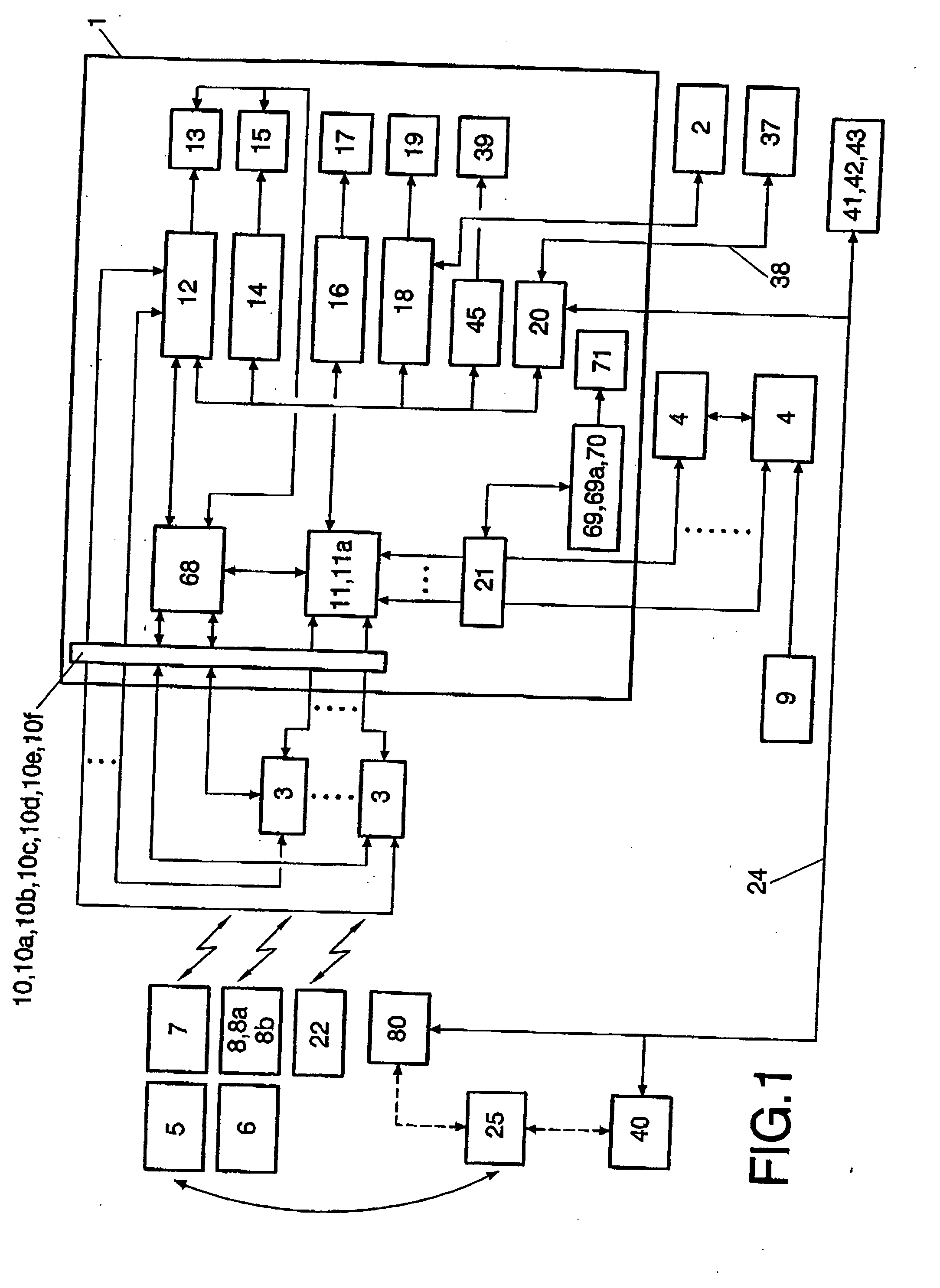

Digital mobile telephone transaction and payment system

InactiveUS20060224470A1Small paymentAcutation objectsAccounting/billing servicesSpeech soundPayment system

Allows for the use of any type of mobile telephone as an activating equipment for payment devices using any mobile telephone network employing any technology in any country connected to the system. Includes a group of payment and operations processing centres (1) in different countries, which are interconnected through international addressing processors (2) to carry out transactions and payments among users-payers and beneficiaries associated to the system in either the same or different countries. The centres (1) have a specific structure in order to allow for different types of purchases, consultations, modifications and the authentication of payment devices. The invention allows for all of the different messages exchanged to use voice messaging. In addition the invention allows for the use of a mobile telephone of a beneficiary / merchant as a POS (22) to carry out transactions.

Owner:MOBIPAY INT

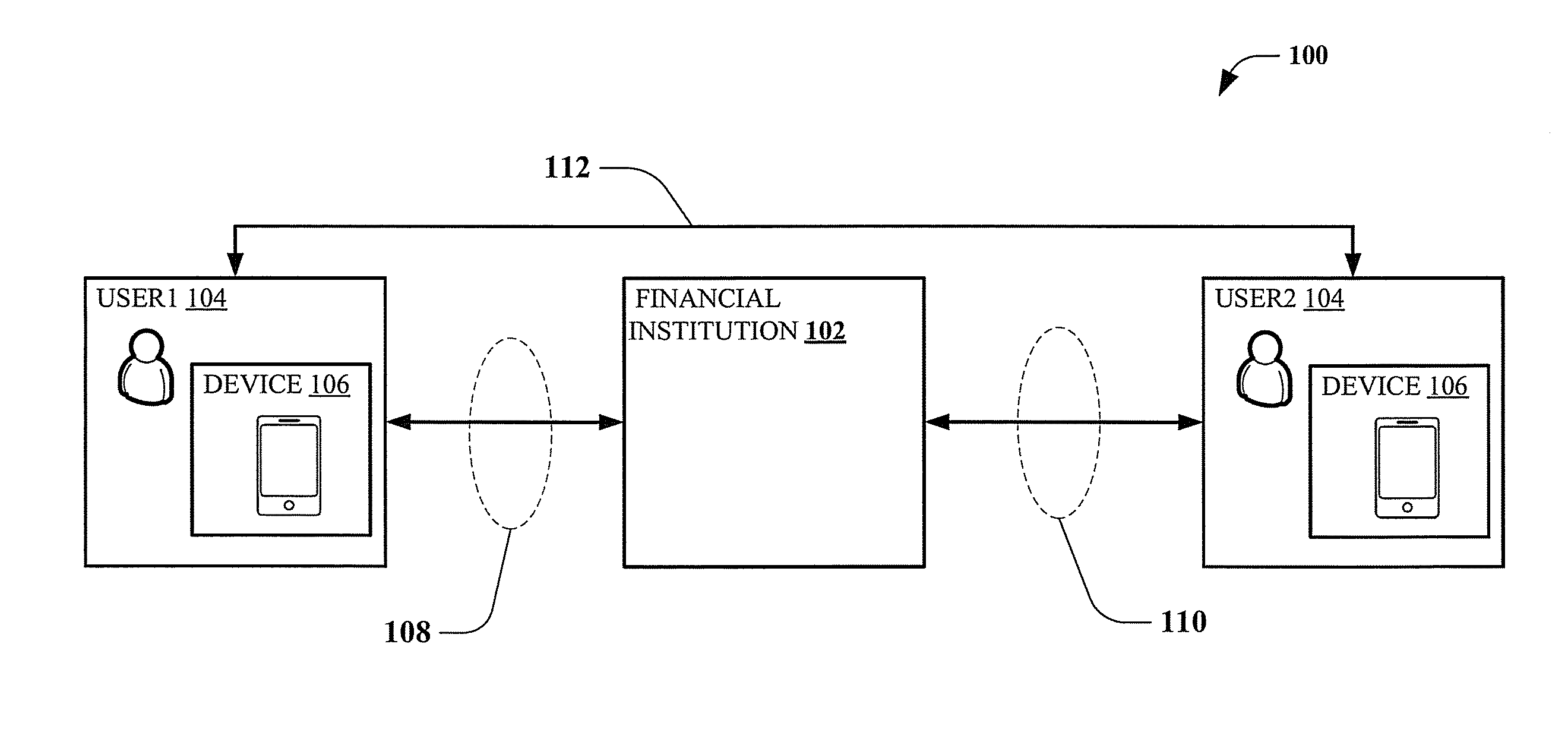

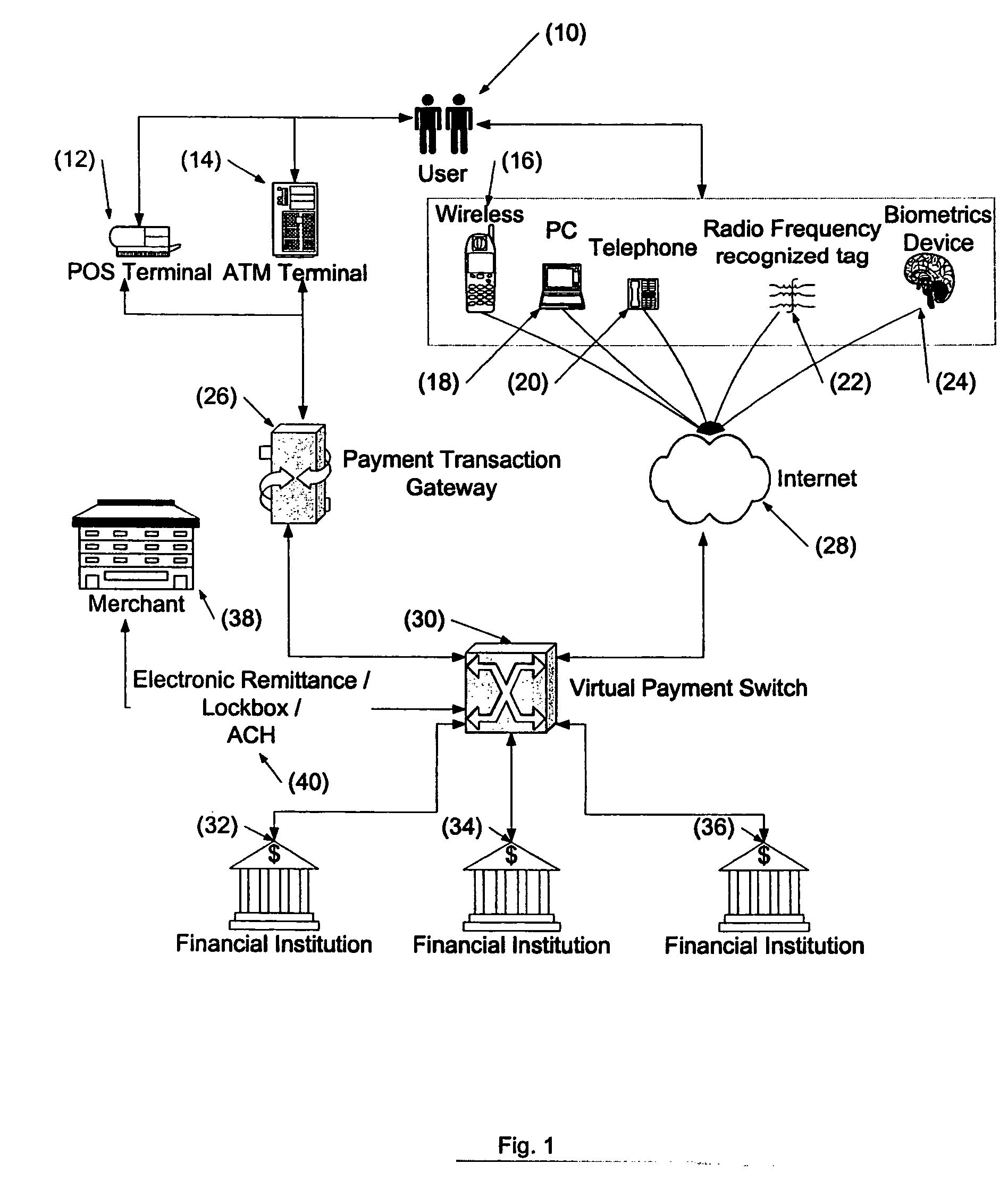

Electronic payment systems and supporting methods and devices

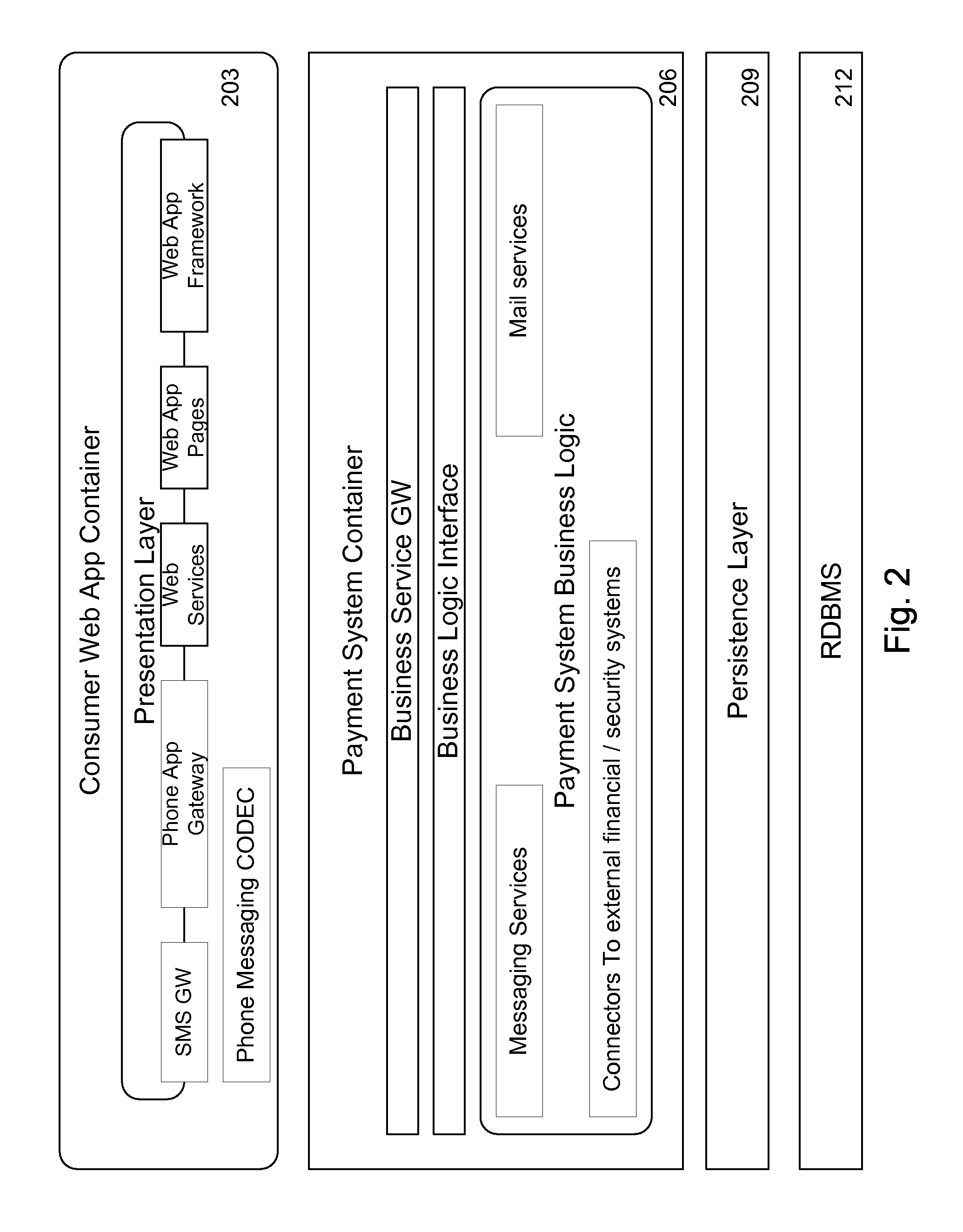

ActiveUS20130060690A1Efficient transferFinanceProtocols using social networksSystems designSubject matter

Electronic payment systems and supporting methods and devices are described. For instance, the disclosed subject matter describes aggregated transactional account functionality configured to receive electronic financial transactions associated with one or more of a set of electronic identifying information such as phone ID, email, instant message, etc. for a user and related functionality. The disclosed details enable various refinements and modifications according to system design and tradeoff considerations.

Owner:RPX CORP

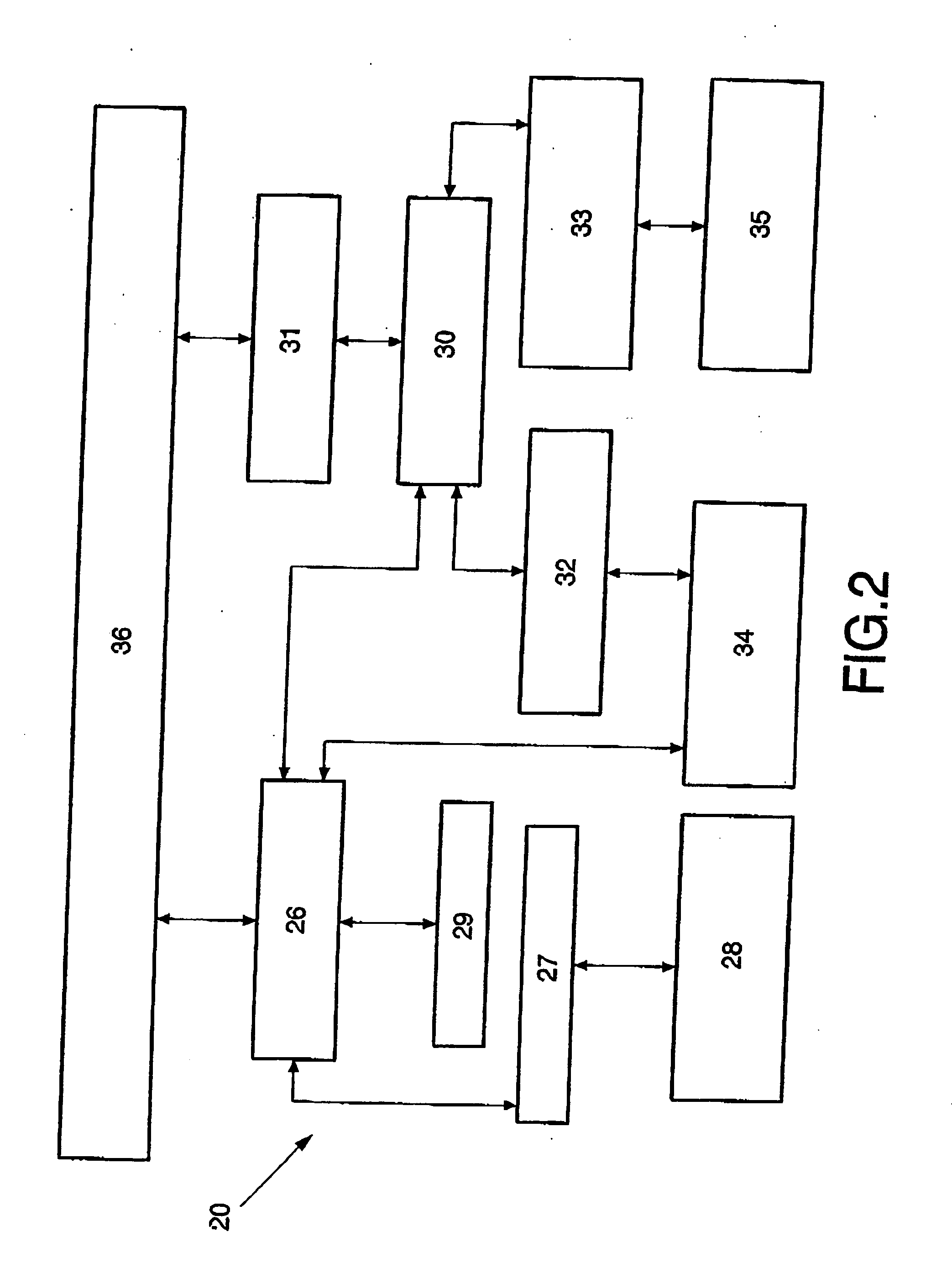

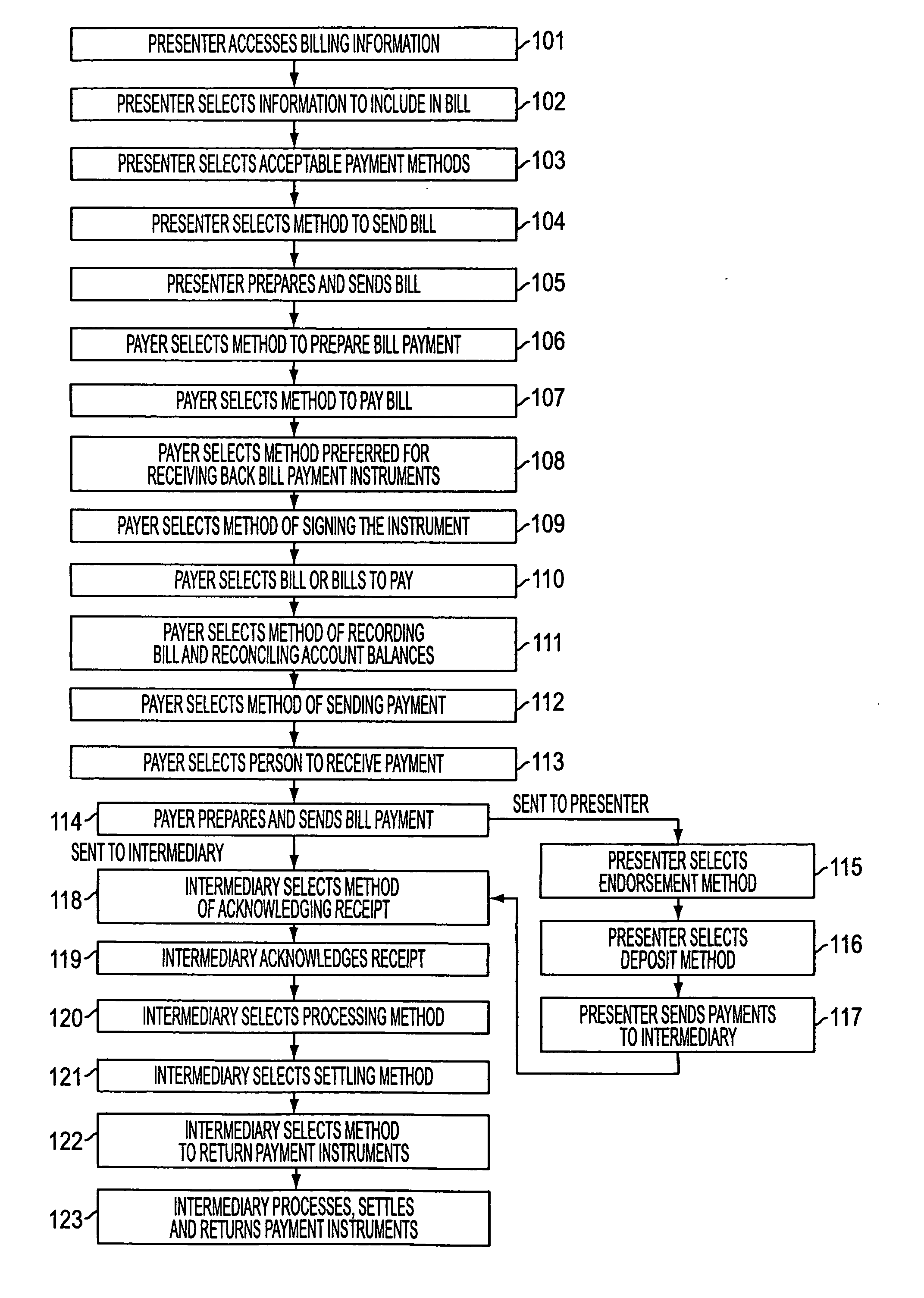

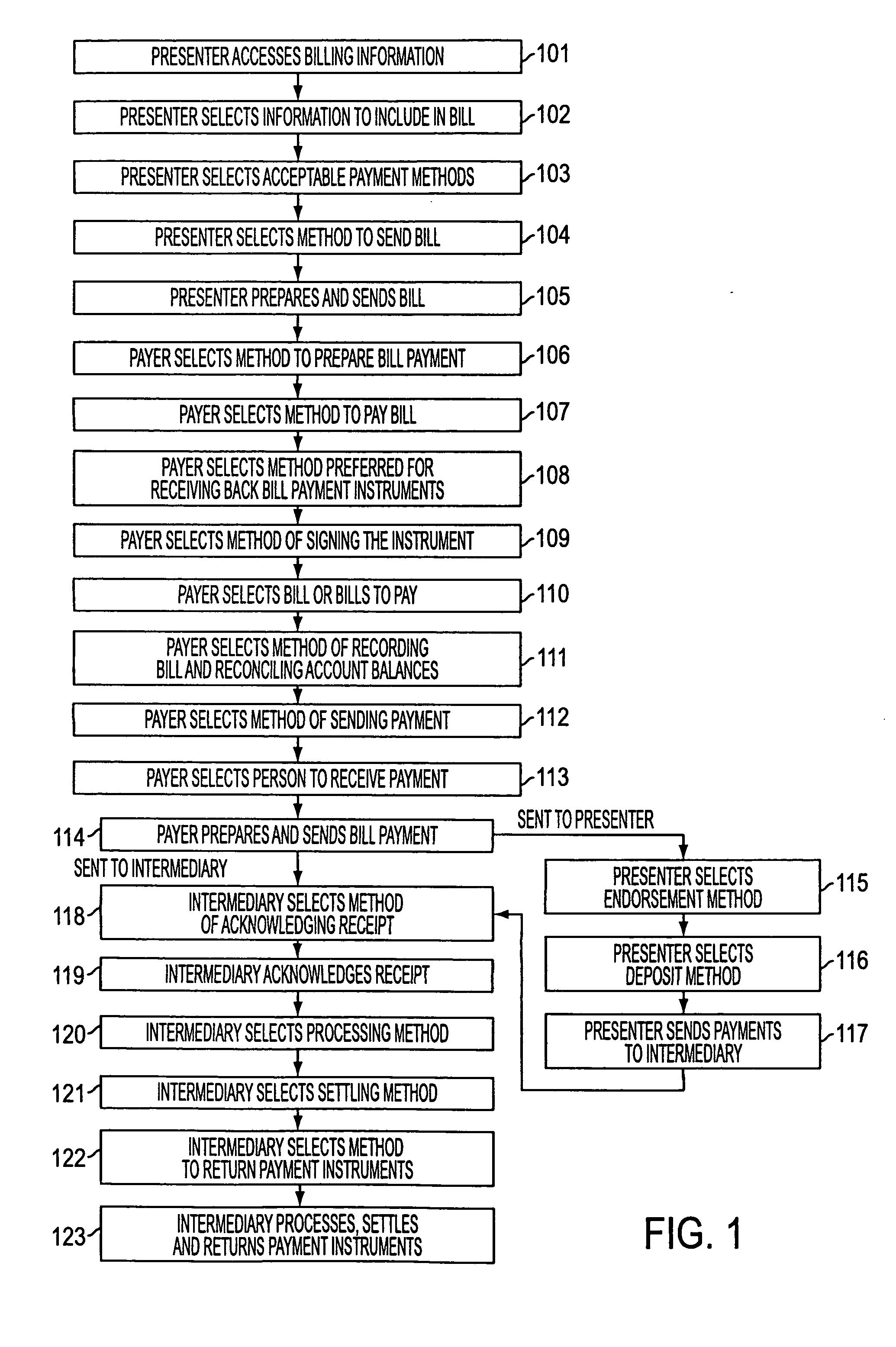

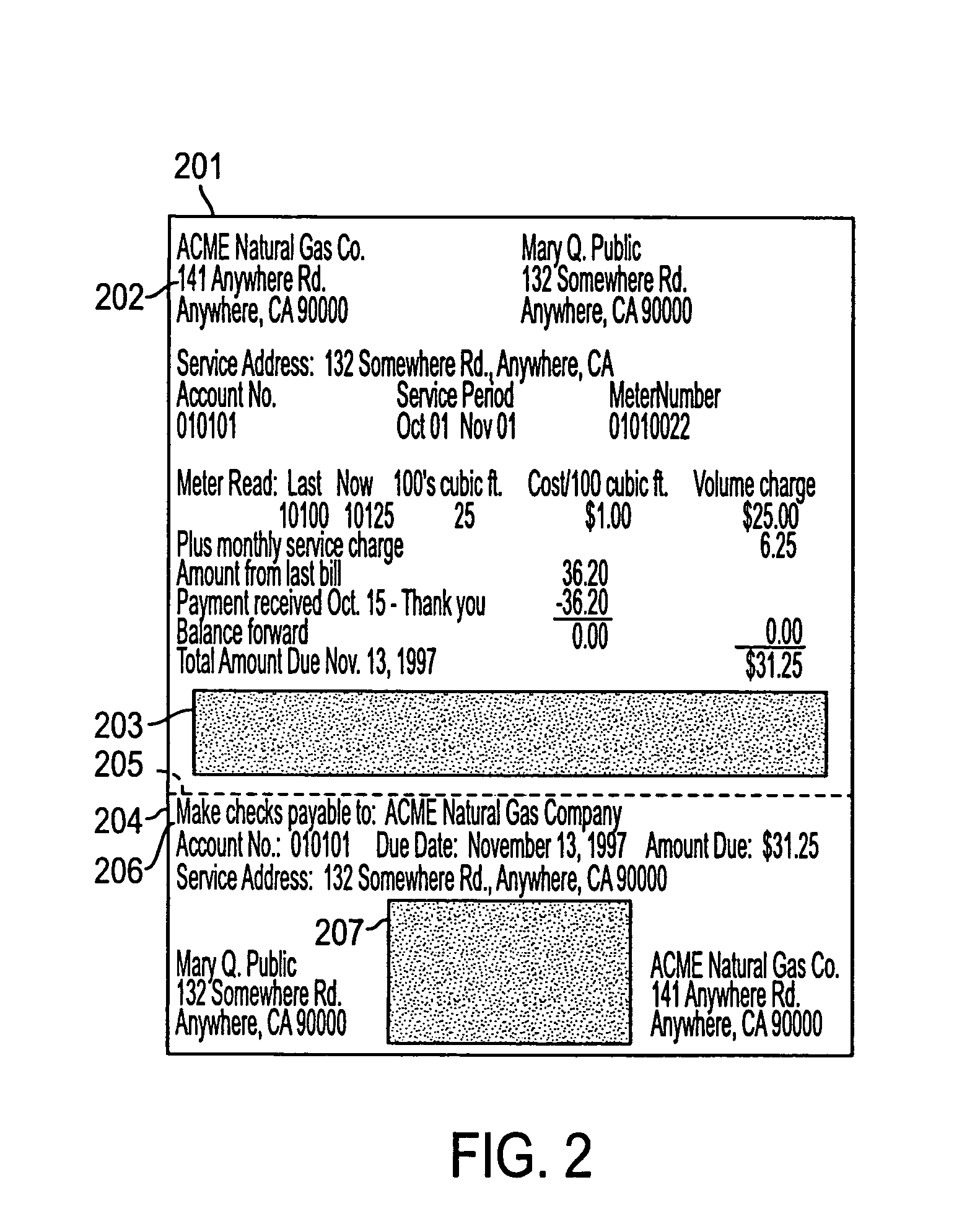

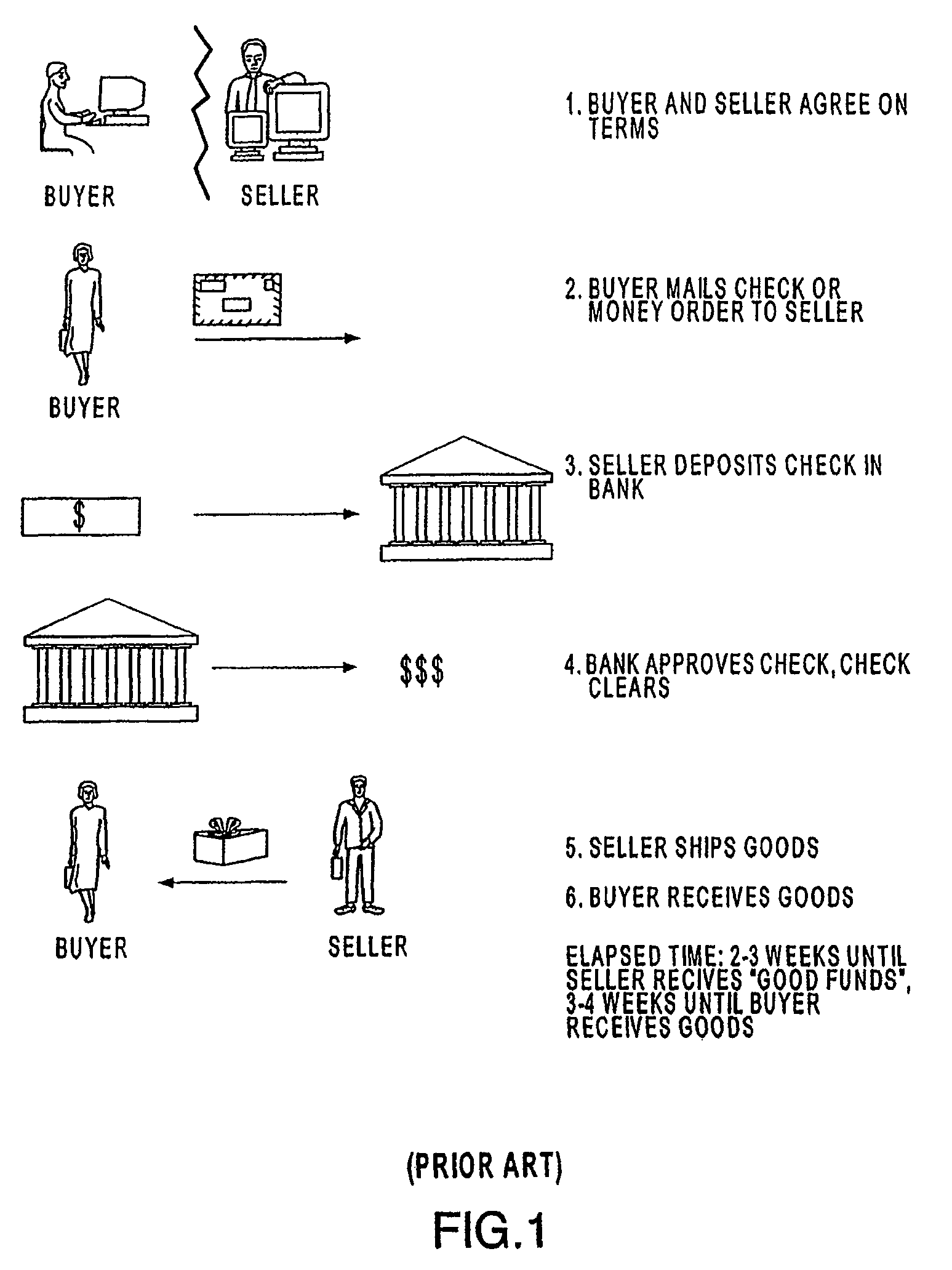

System and method for digital bill presentment and payment

InactiveUS20050033690A1Reduce complexityEnhanced interactionFinancePayment architectureCredit cardDigital data

A system of bill presentment and bill payment. The parties to the process, which typically include the bill presenter, bill payer, and bank, credit card company or other intermediary, select from a number of choices in the selection of information to include in the bill, preparation of the bill, acceptable payment methods, means to send the bill and bill payment instrument, means of signing the bill, bill payment instrument, receipt acknowledging deposit and payment, method of recording and reconciling payments, and further actions. An accumulation of choices by the involved parties can include digital information in each step that represents all of the significant data accumulated up to and including that step. That digital data preferably includes digital signatures of each party at each step so as to provide an audit trail in purely digital form. Where digital data is chosen for each step, the digital data can be electronic or, using machine readable code, printed on paper, regardless of the form chosen in prior or later steps.

Owner:ANTOGNINI WALTER GERARD +1

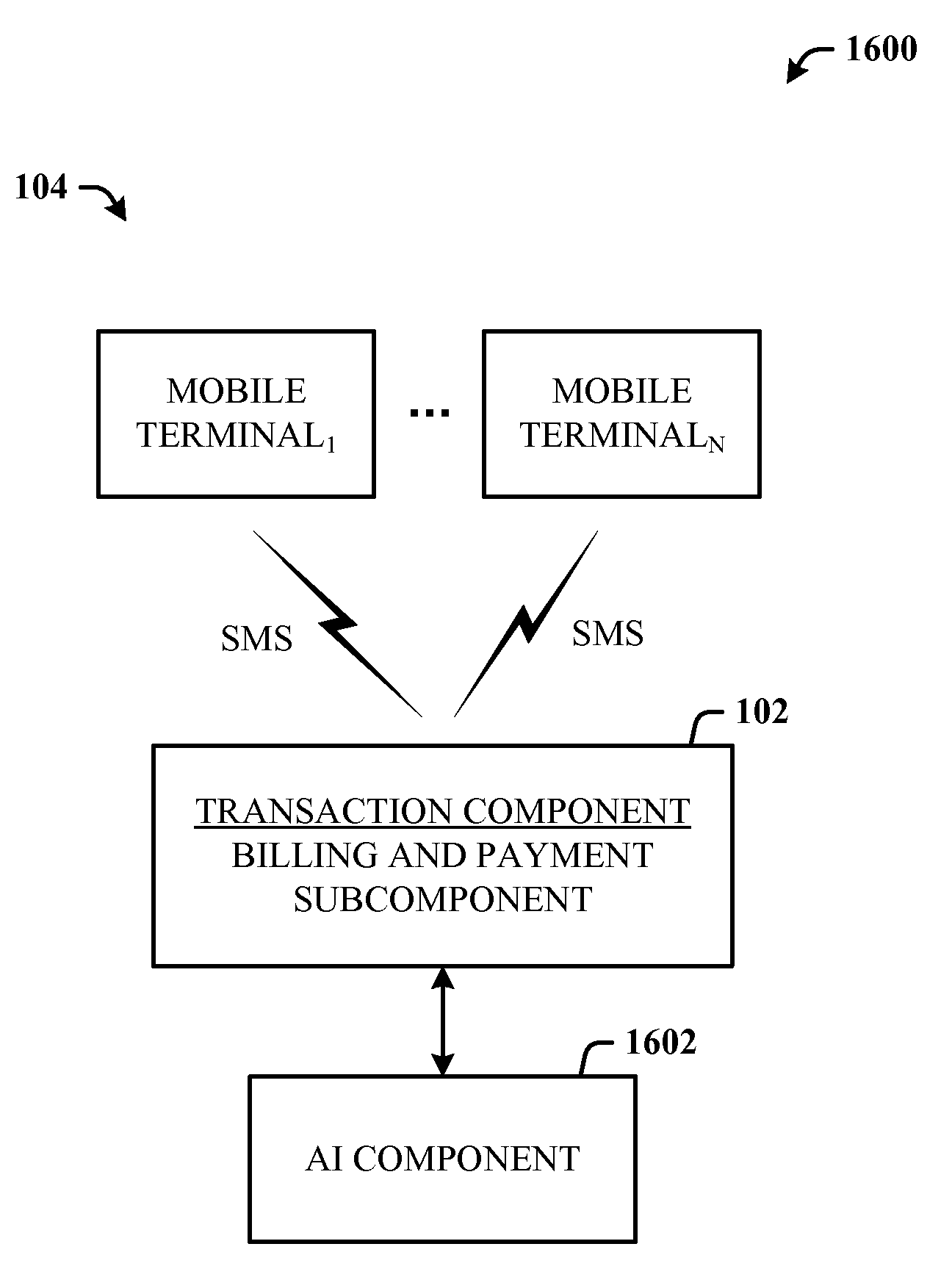

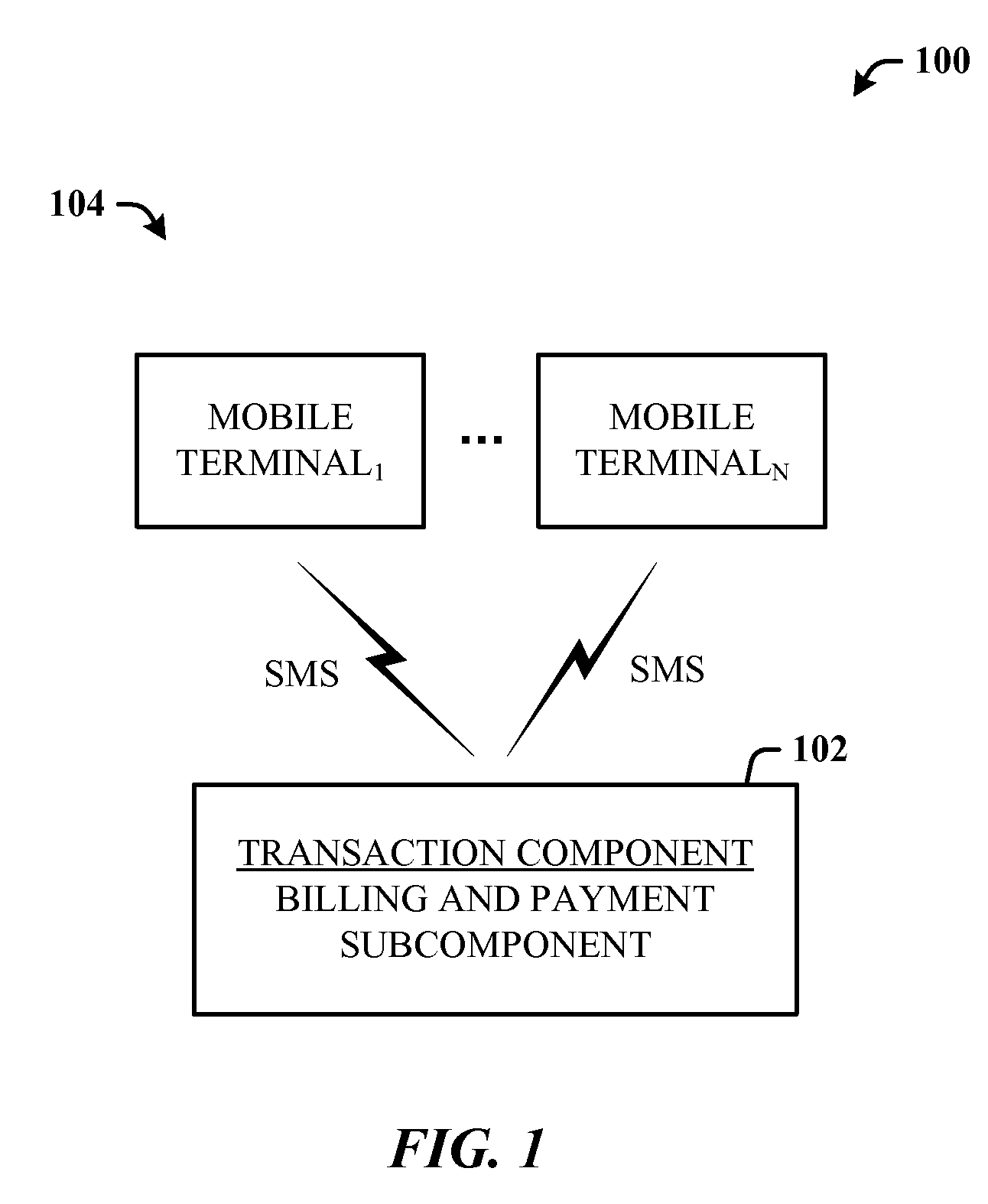

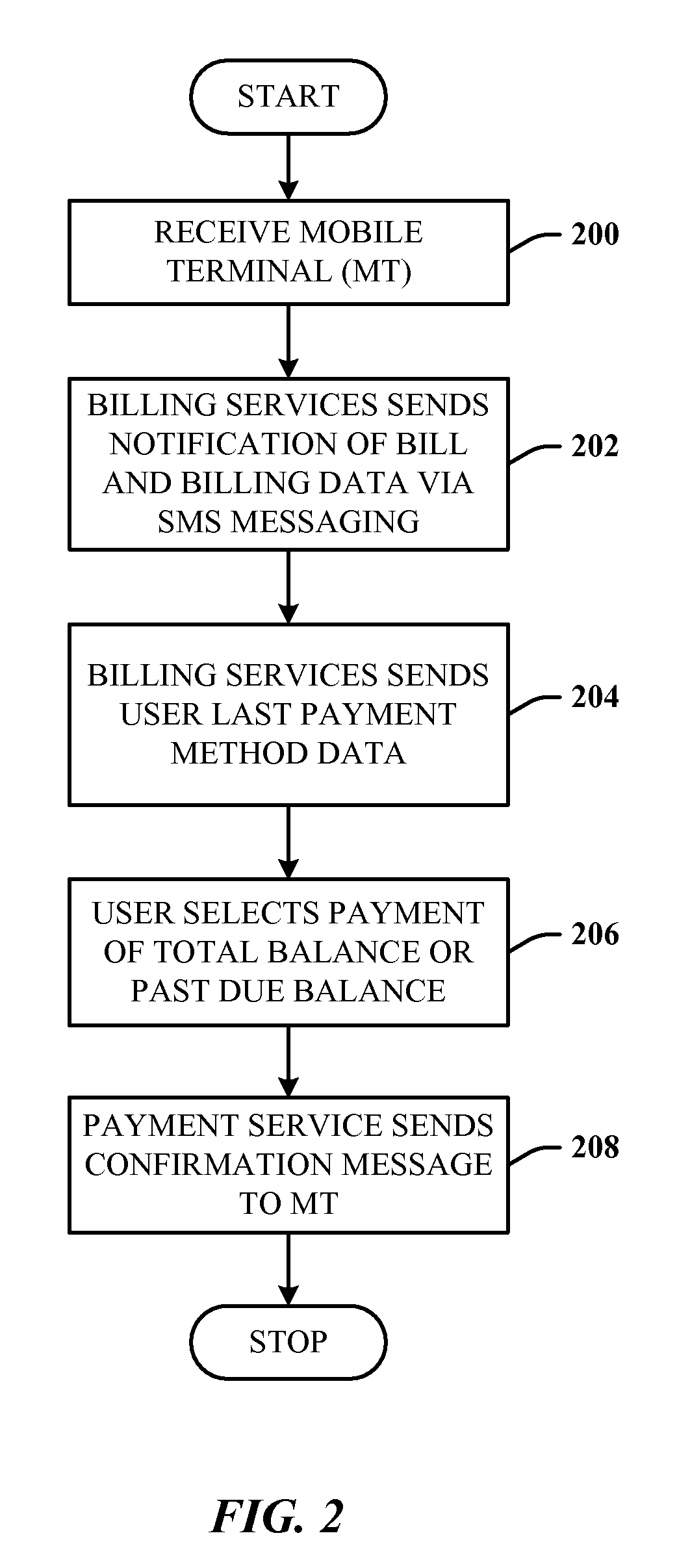

Mobile communications billing architecture

InactiveUS7945240B1Low costEasy accessPayment architectureSubstation equipmentCredit cardBank account

A telecommunications payment system which includes a transaction component that facilitates the communication of at least billing and payment information to at least one of a plurality of mobile terminals. In operation the carrier will cause the transaction component to communicate an SMS message to the mobile terminal that includes a billing notification message. The notification message can include a current account balance, including total and past due, if applicable, the user's last payment method, and personal financial account data such as the last four digits of a credit card and / or bank account file. When providing the proper reply, payment processing is initiated such that an amount of funds will be transferred from the user's financial institution to the carrier back-office systems or its financial institution.

Owner:CINGULAR WIRELESS II LLC

Systems and methods to determine the name of a location visited by a user of a wireless device

ActiveUS8229458B2Particular environment based servicesDevices with GPS signal receiverCommunications systemMobile device

Methods and systems that record the location of a user and transmit targeted content to a user based upon their current and past location information. A network is configured to include a server programmed with a database of targeted content, a database of location information, a database of user information, a database searching algorithm, and a wireless communication system capable of communicating with the user's mobile device. The location of the mobile device is ascertained and recorded. The location information is analyzed to determine the routes taken by the user, businesses visited by the user, and other behaviors of the user. Targeted content is sent to the mobile device of the user and whether the user visits the physical locations associated with the targeted content is monitored. Payment systems, phone exchange systems, and other features may also be integrated to provide detailed conversion tracking to producers of targeted content and business owners.

Owner:META PLATFORMS INC

Smart communication device secured electronic payment system

InactiveUS20130204793A1Prevent fraudMinimizes likelihood of liabilityFinanceAnonymous user systemsPayment transactionDocumentation

Systems, apparatuses, and methods enabling secure payment transactions, and methods for sharing secure documents, via a mobile device, for example a mobile telephone, smartphone, cellular telephone, other wireless device, a Near Field Communications (NFC) device, or the like. Actual user account information is substituted with temporary account information such that the temporary account information may be manipulated in a manner similar to actual user account information, with the result that actual account information is masked thereby greatly reducing the likelihood of misuse.

Owner:KERRIDGE KEVIN S +1

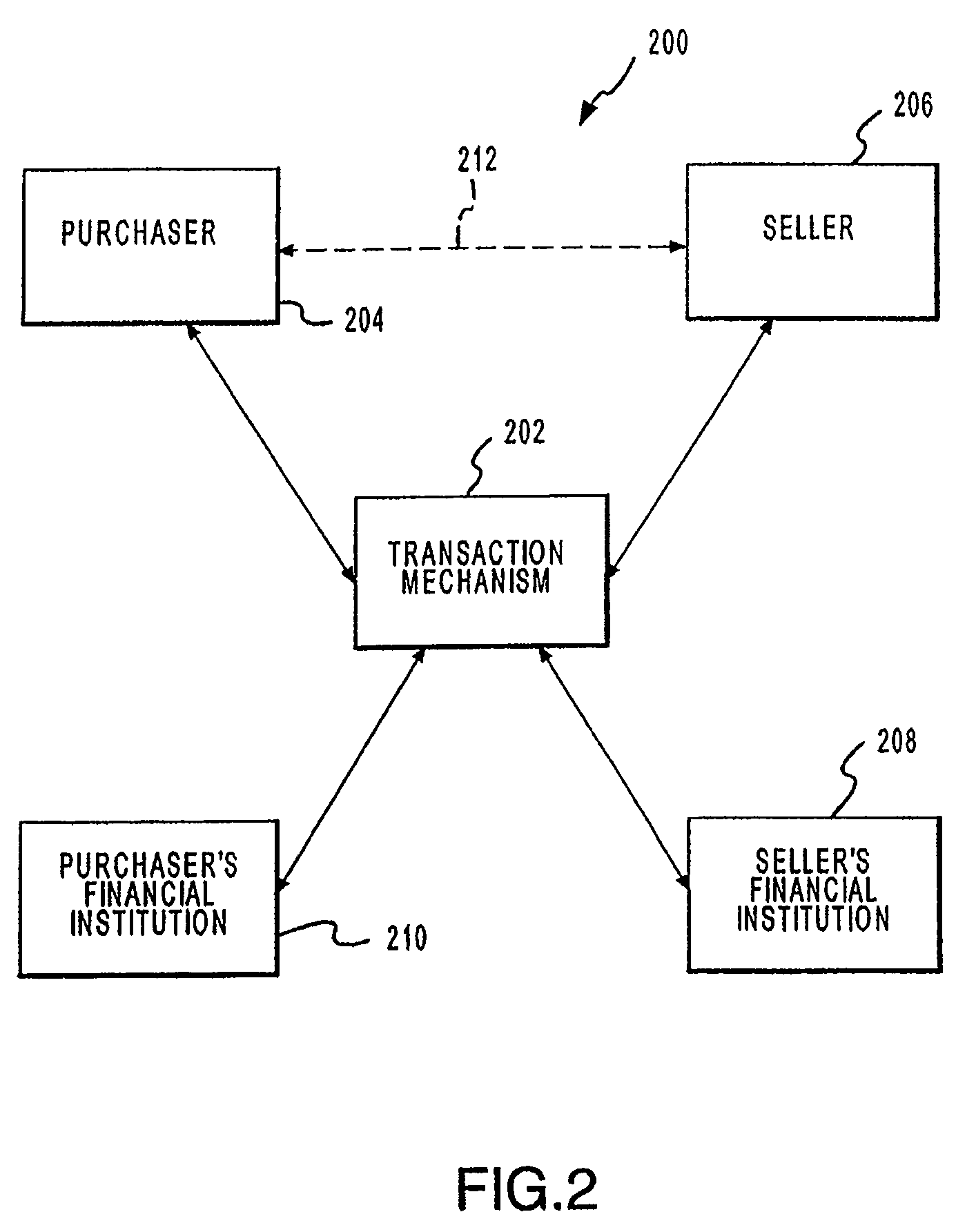

Distributed Payment System and Method

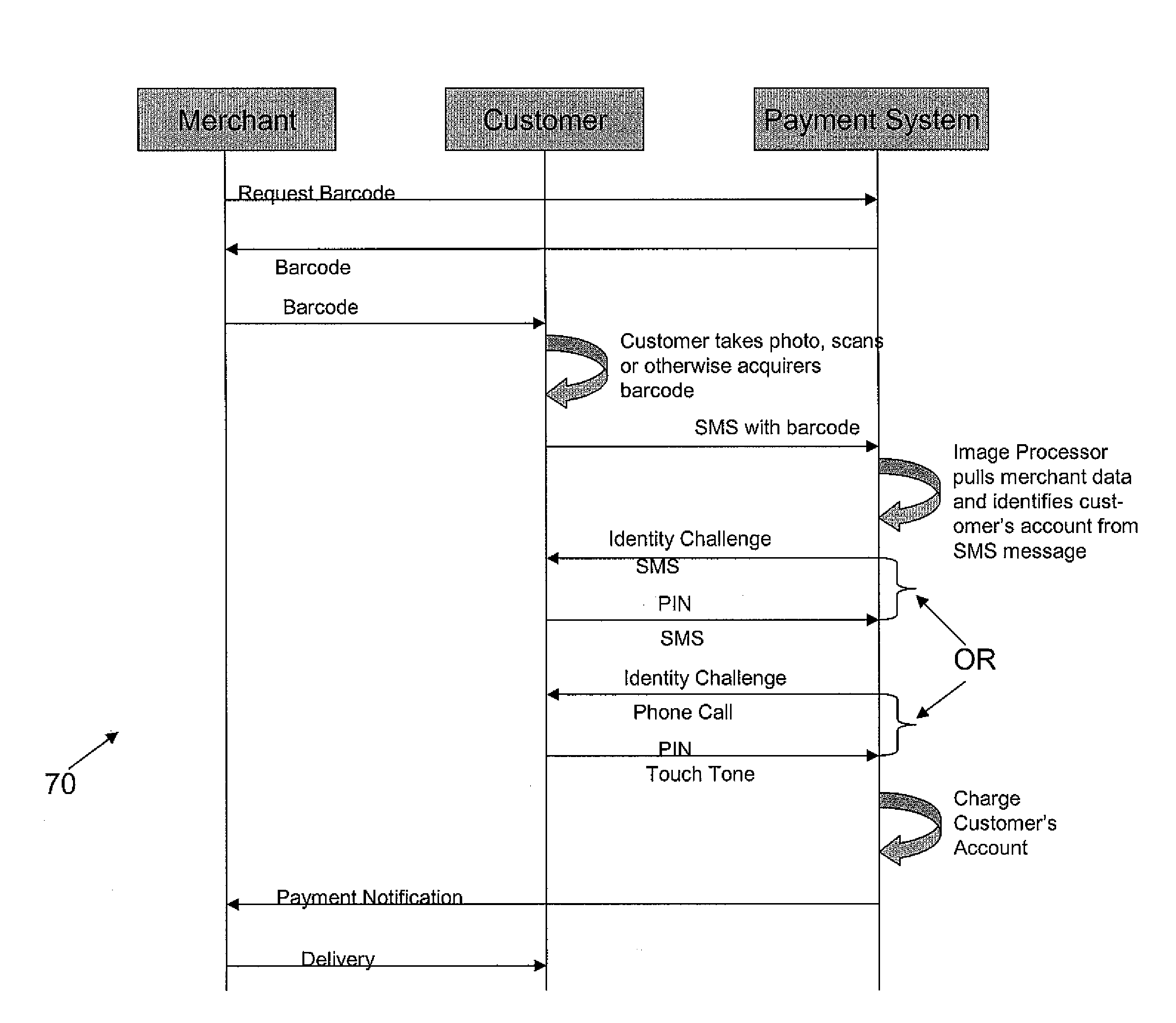

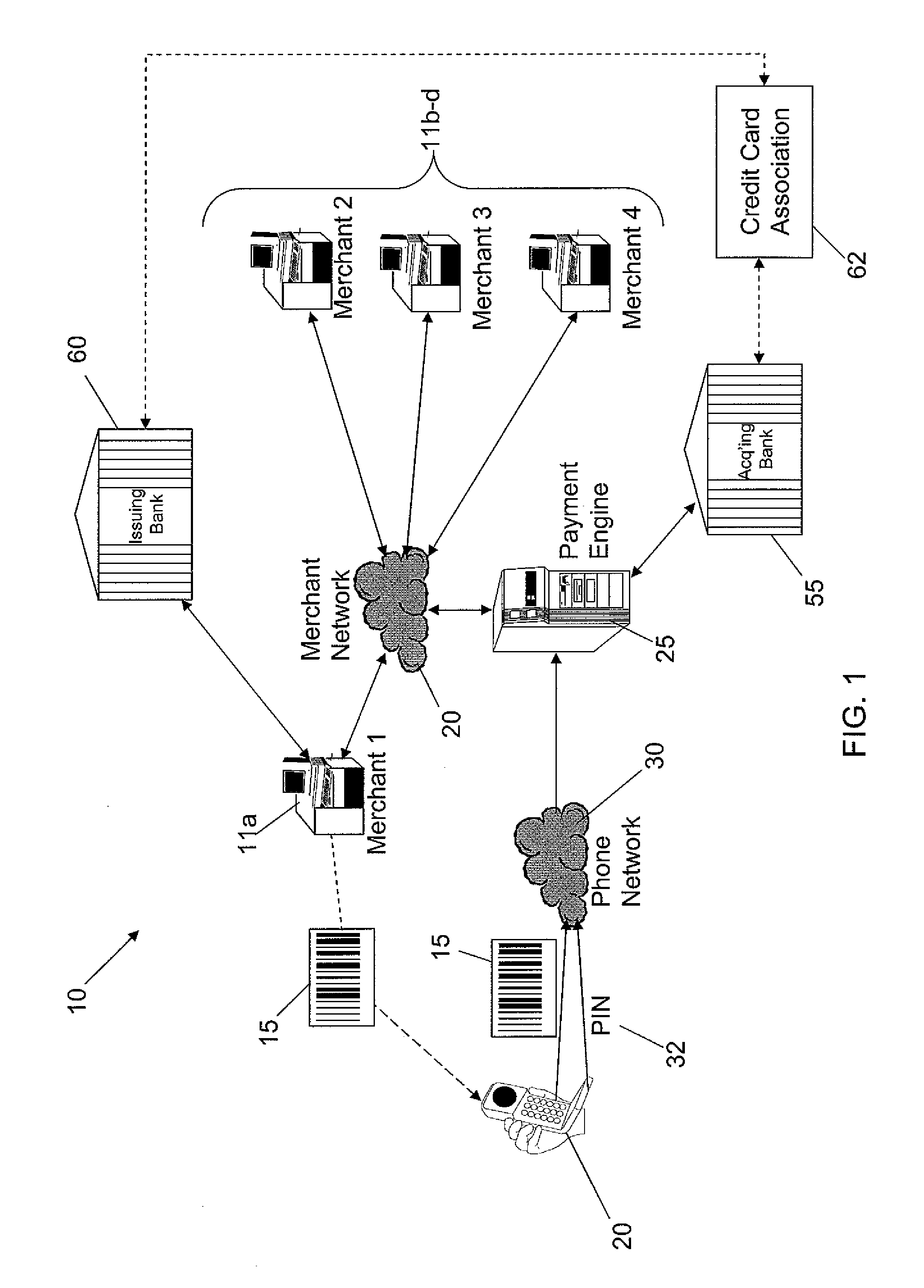

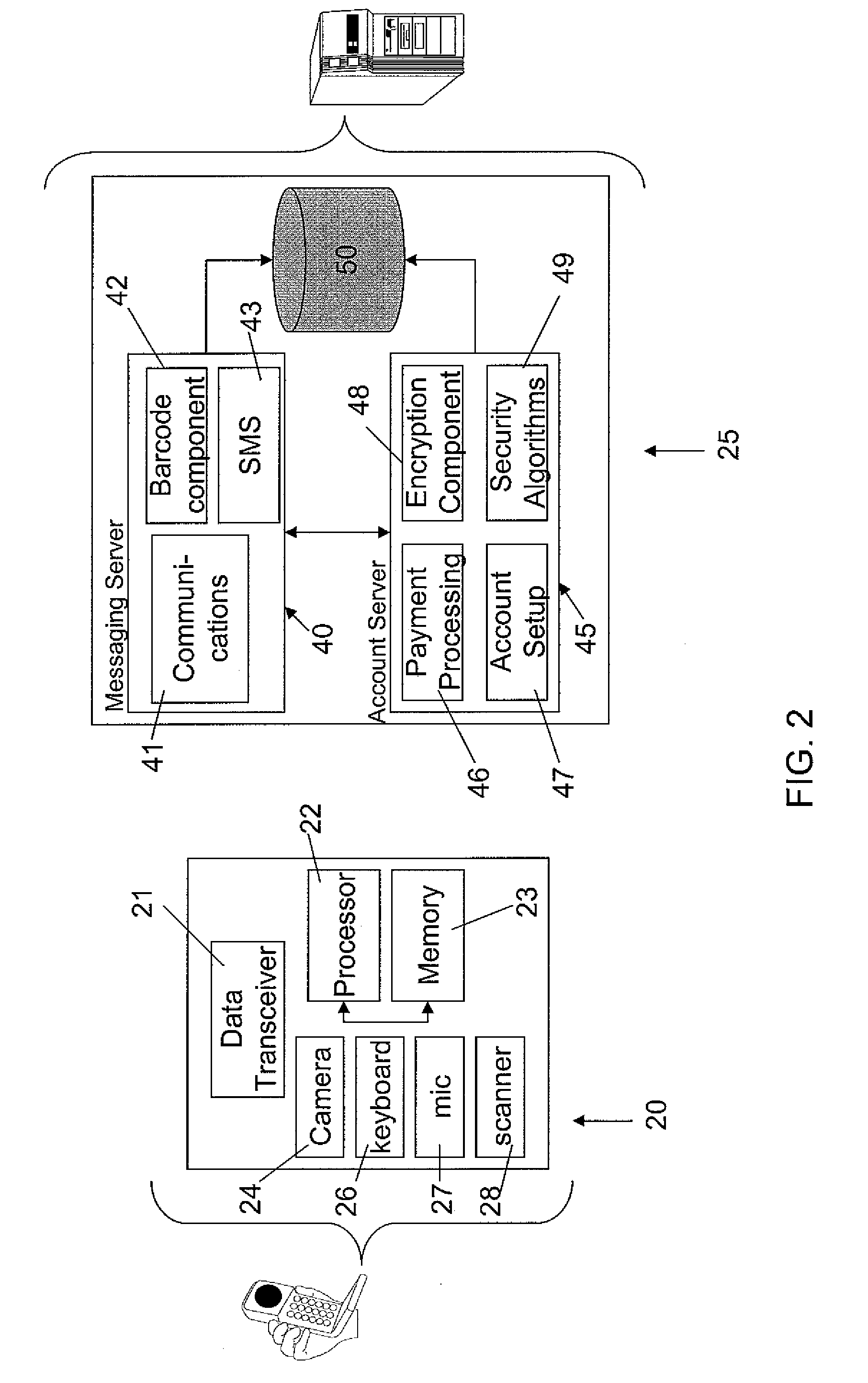

ActiveUS20080222048A1Easy to use interfacePromote rapid adoptionFinanceUser identity/authority verificationUniversal Product CodeBarcode

The present invention provides a payment system that allows a mobile communications device (MCD) to interact with a merchant processing device (MPD) and a payment engine. A communications component associated with the payment engine can send requested barcodes to the MPD, receive barcodes or alphanumeric Universal Product Codes from customer MCDs, and handle payment authorizations and settlements. A barcode management component can generate and interpret barcodes based upon merchant offerings and client requests. A security algorithms component can employ an offset pair algorithm to convert each digit from a payment card information into an offset pair of digits to facilitate security in accordance with one embodiment of the present invention.

Owner:PLAYSPAN

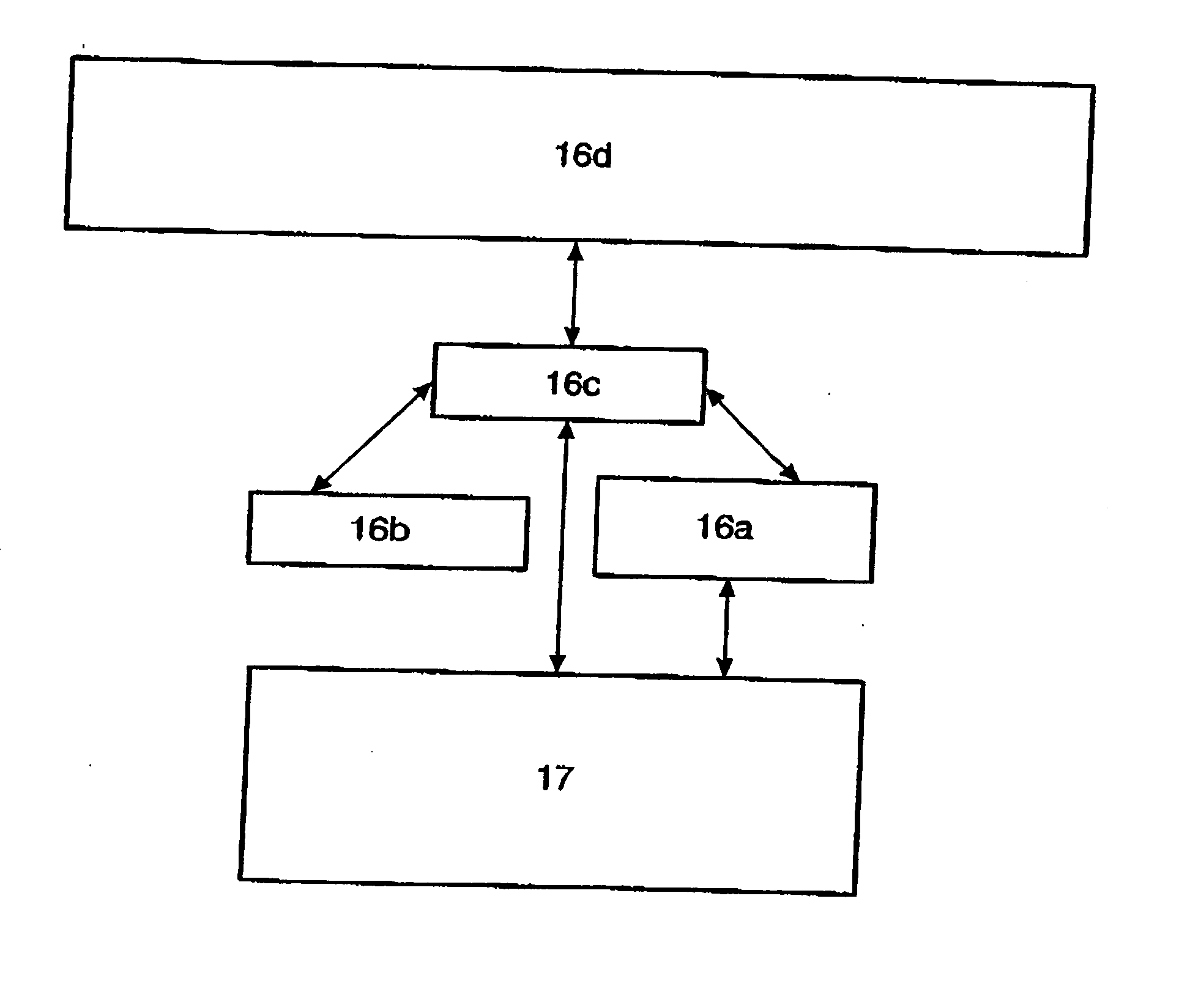

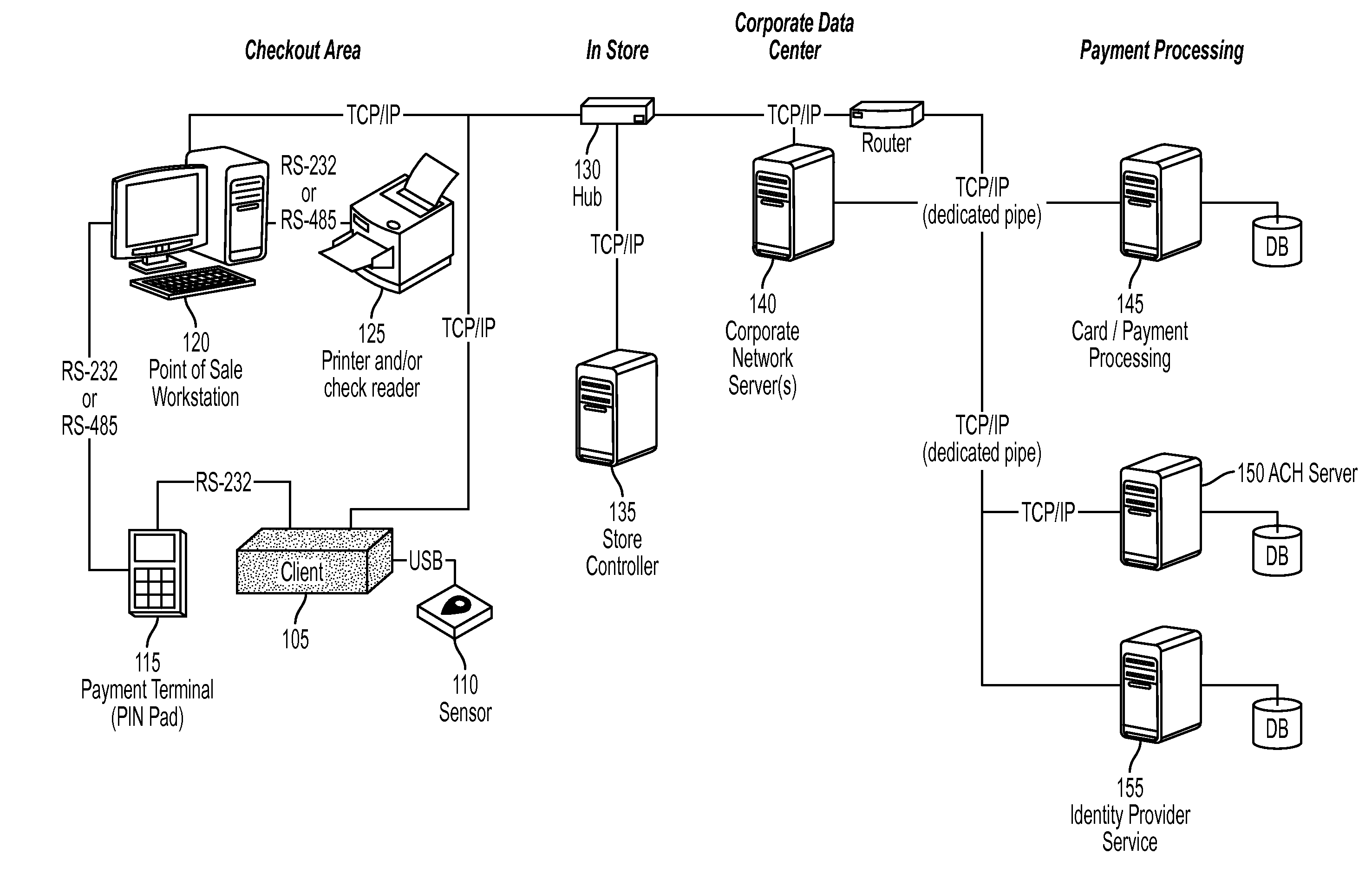

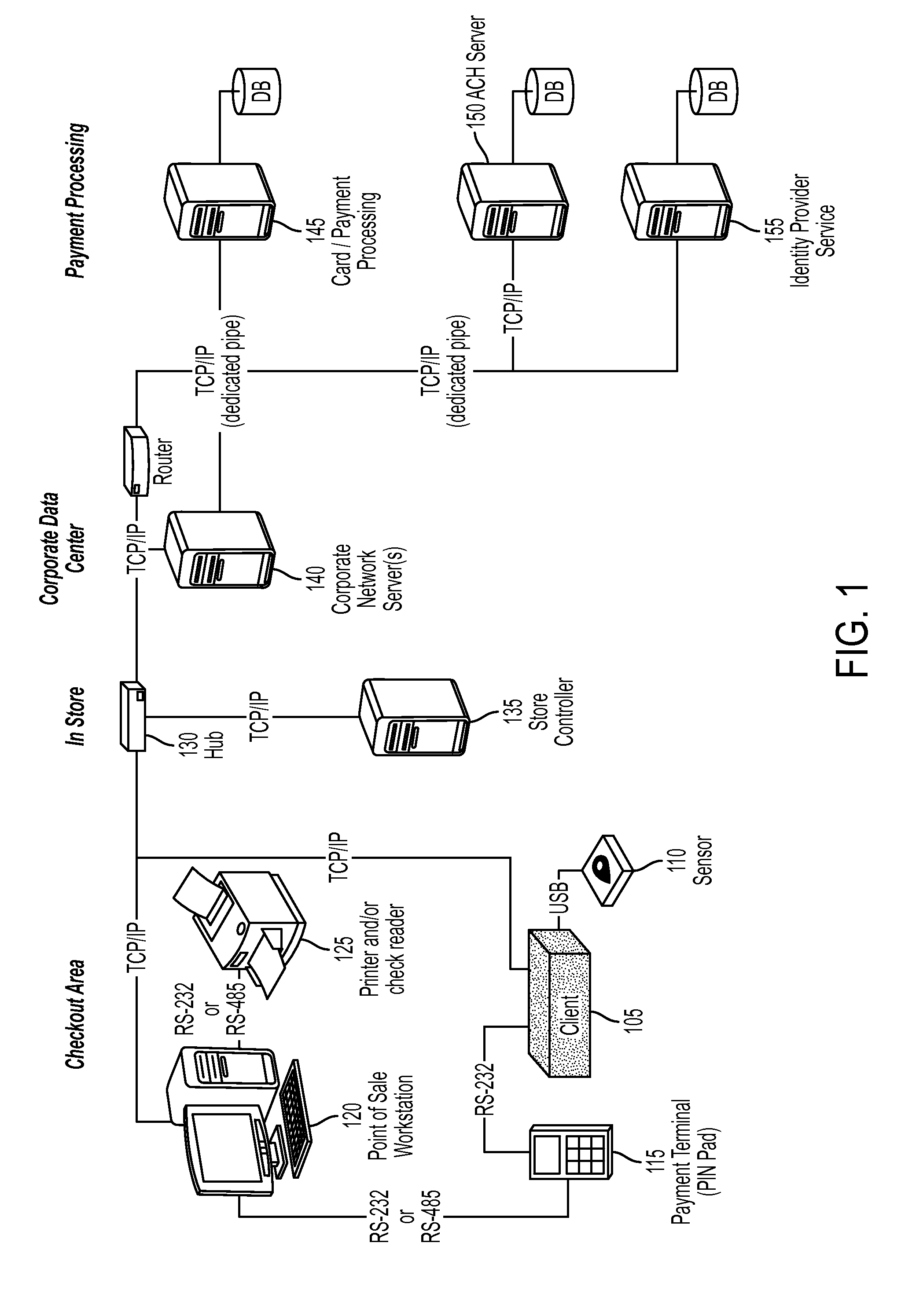

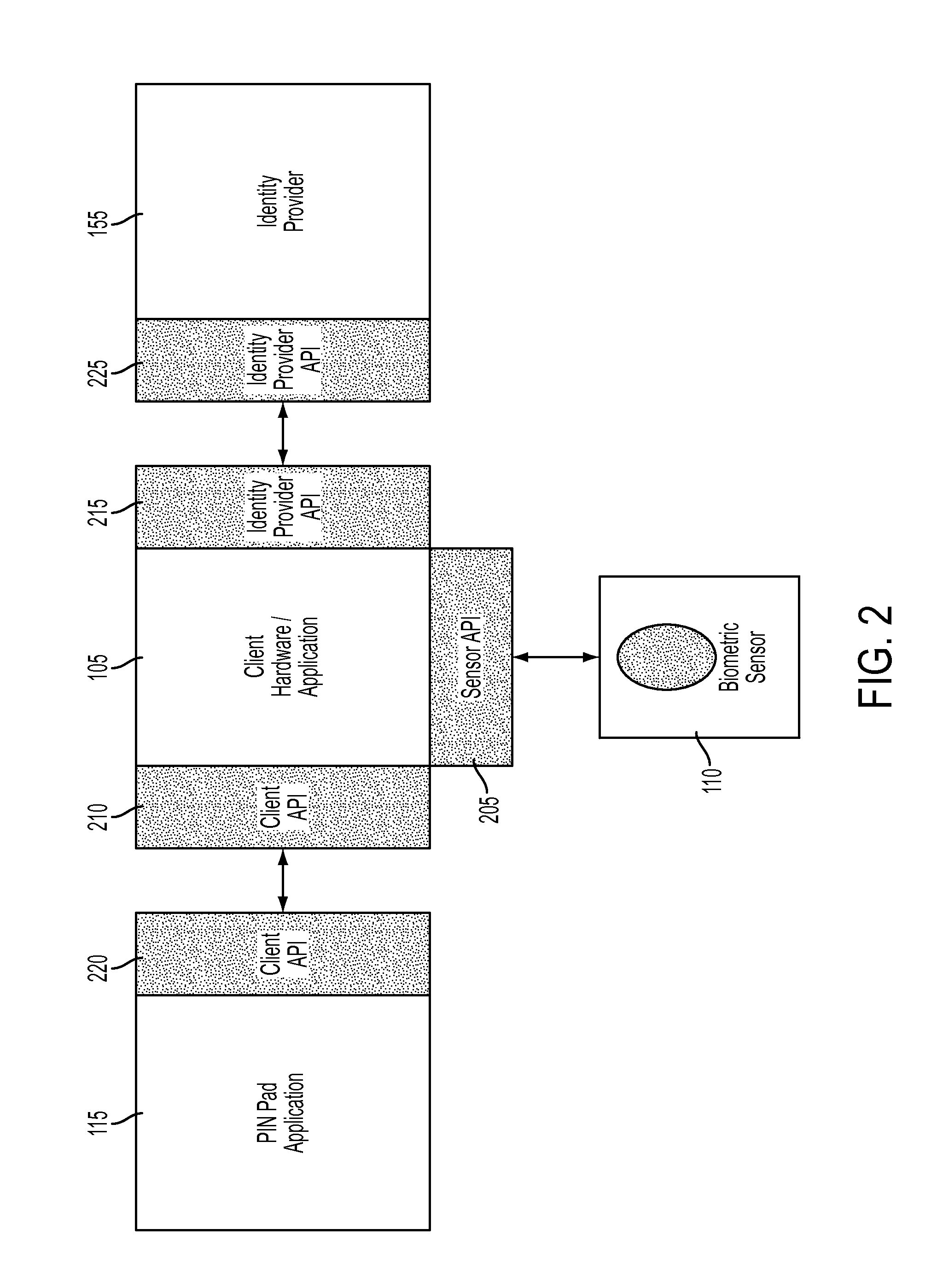

System and architecture for merchant integration of a biometric payment system

A system and method for performing authentication are disclosed. The system may include a shared central processing server, a plurality of software components each residing in a corresponding point-of-sale (POS) workstation and an identity provider service. The server may reside at a merchant location and communicate with multiple POS workstations at the merchant location. The server may be configured to receive biometric information from each POS workstation. Each software component may communicate with a biometric sensor in communication with the corresponding POS workstation to receive biometric information. The identity provider service may be configured to communicate with the server, store registered biometric information and compare biometric information received from the server with one or more of the stored registered biometric information. One of the biometric sensor, a POS workstation and the server may convert a biometric image into a biometric template for comparison with the stored registered biometric information.

Owner:YOUTECH

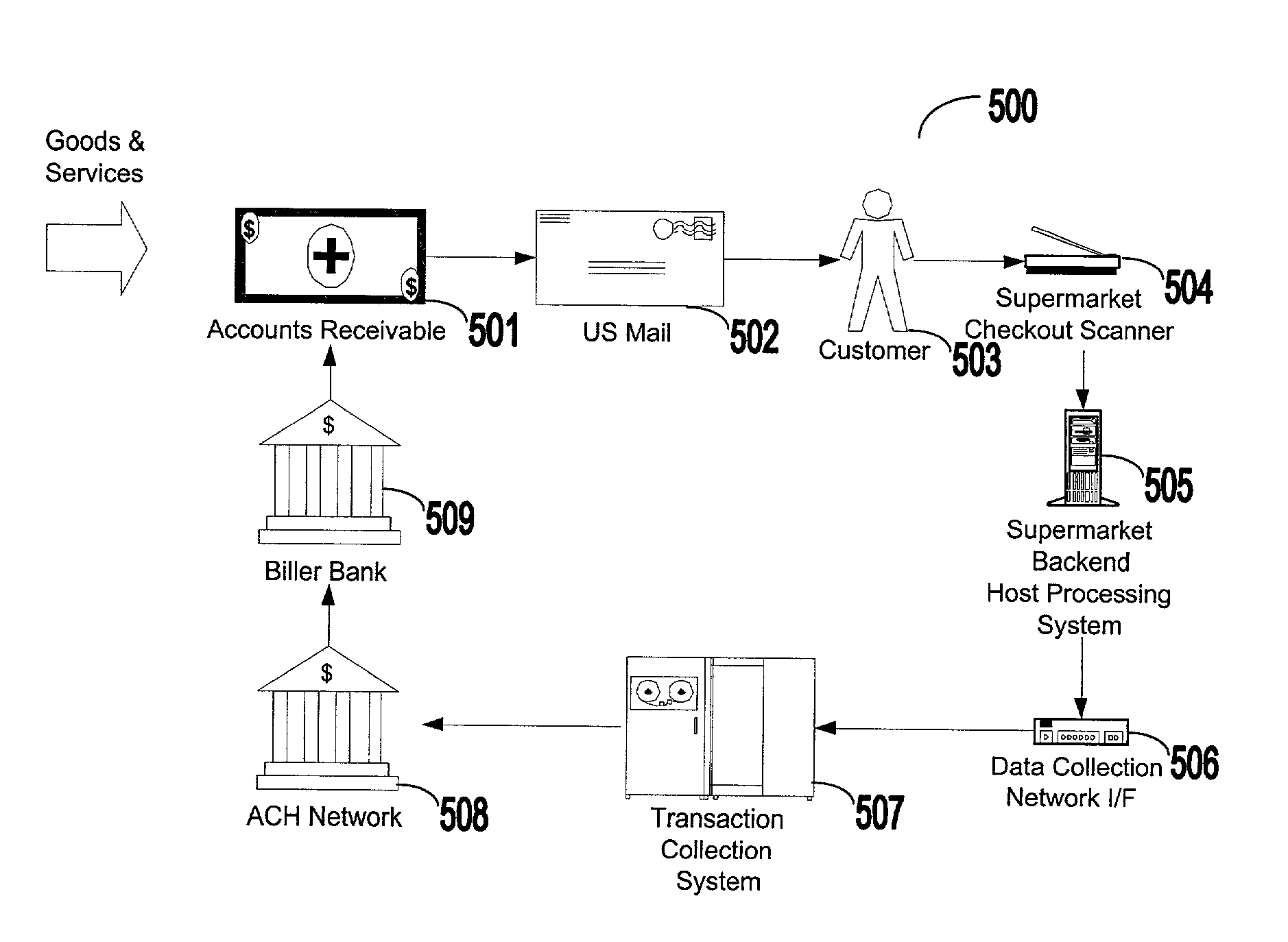

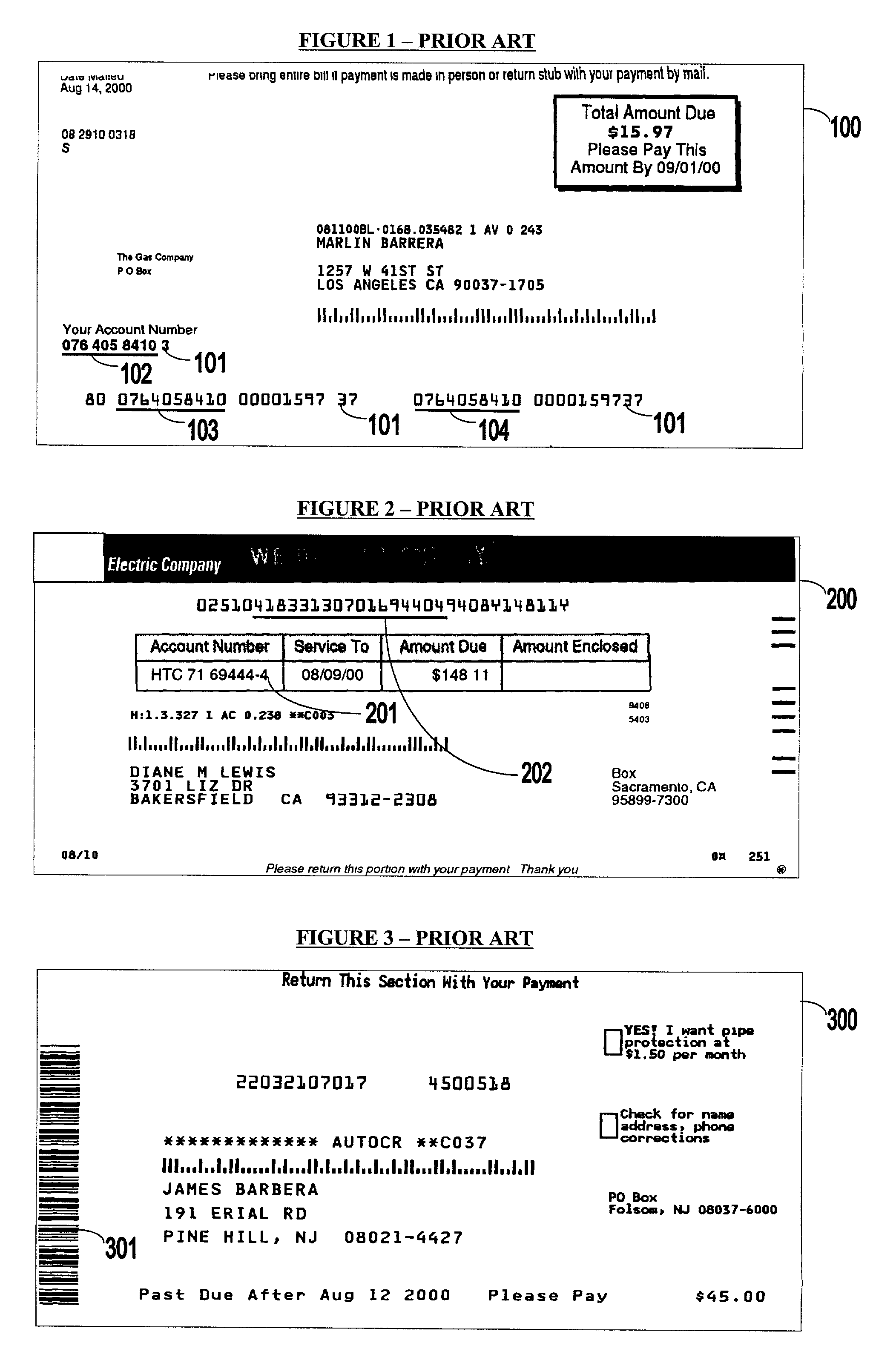

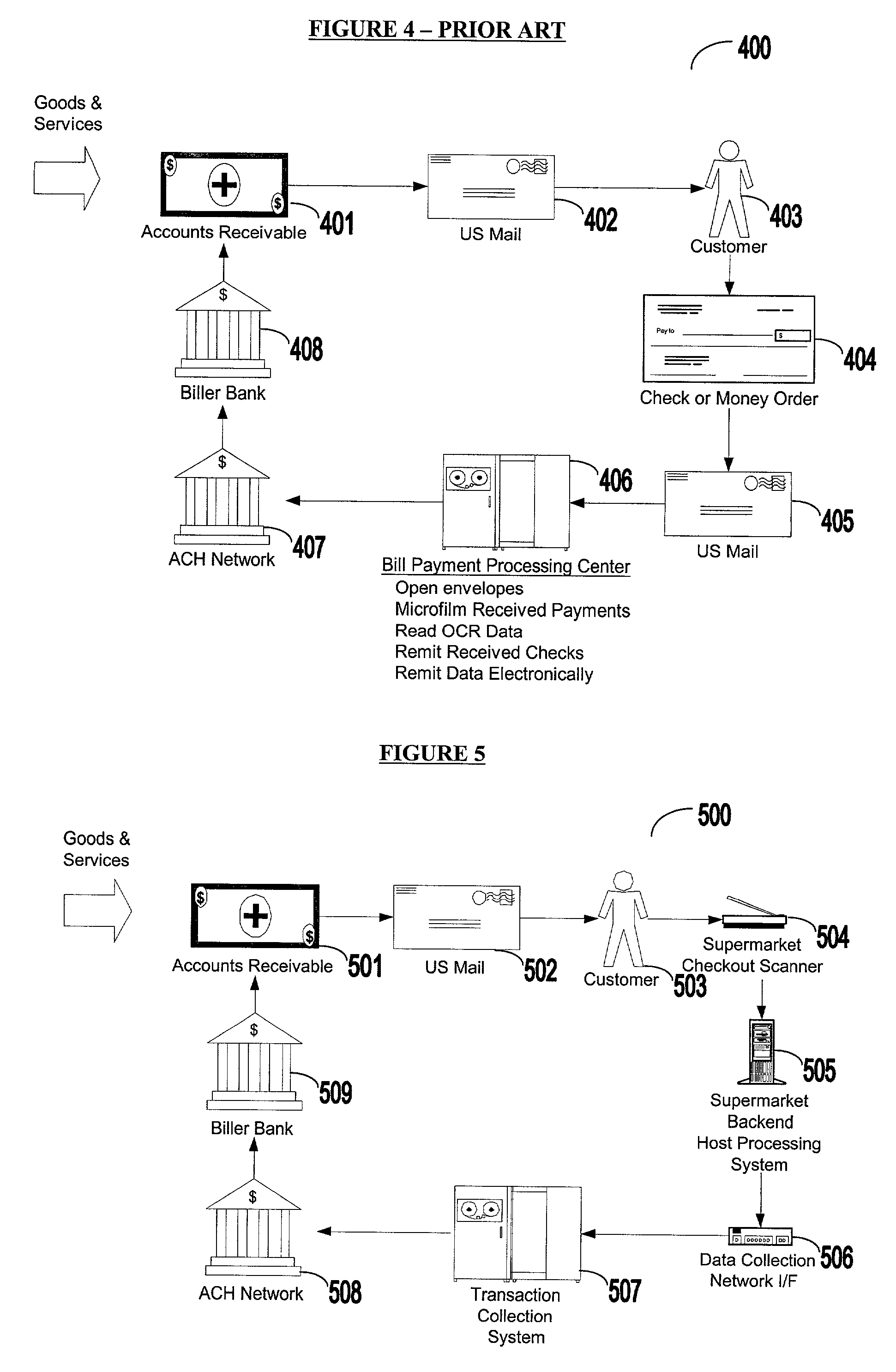

Bar coded bill payment system and method

InactiveUS6993507B2Cost-free profit marginPay their bills more efficientlyComplete banking machinesFinanceThird partyInvoice

Owner:PAYSCAN AMERICA

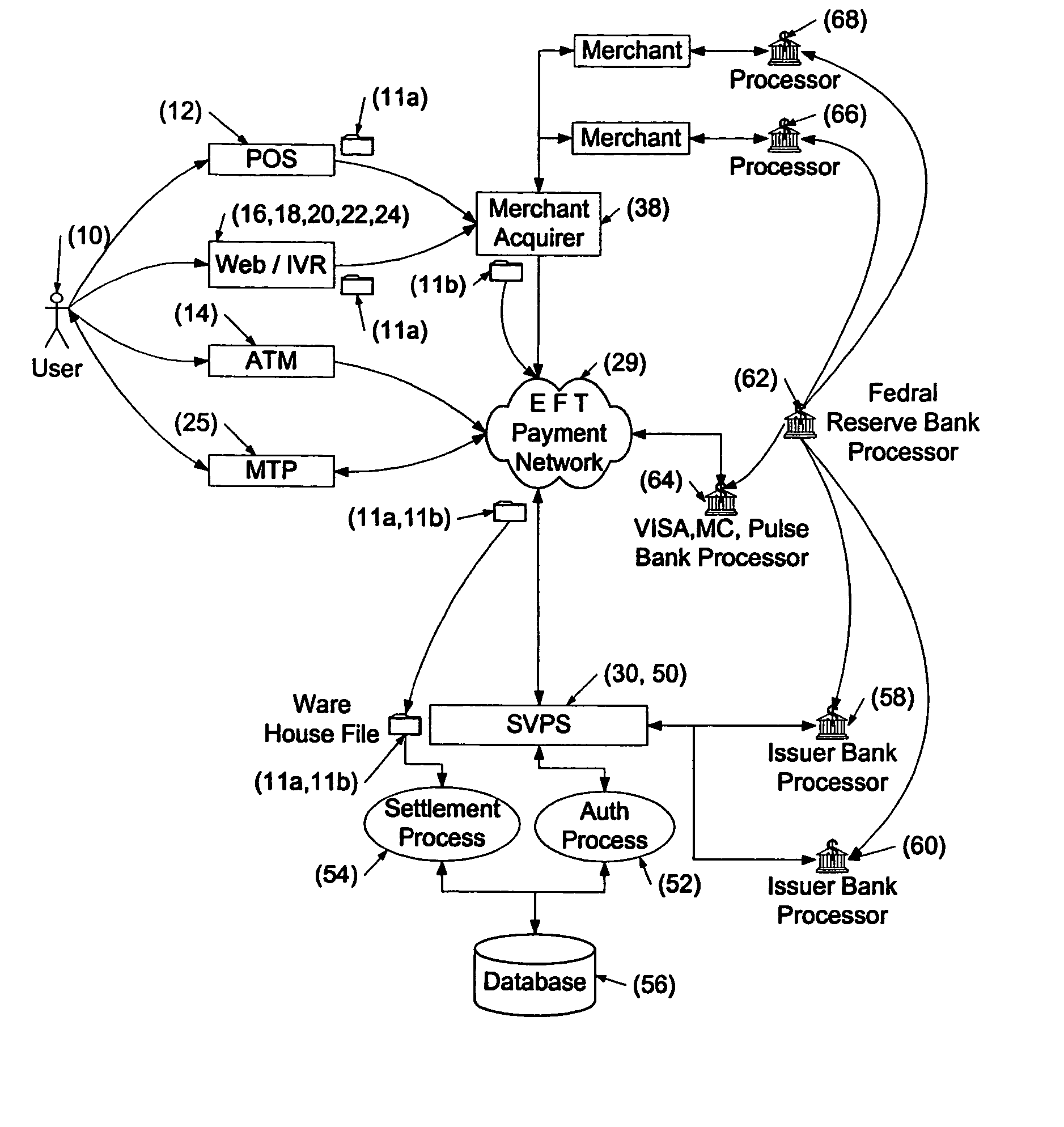

Cashless payment system

InactiveUS20050015332A1Without any loss of transaction processing flexibilityWidespread acceptanceFinanceBuying/selling/leasing transactionsComputer networkEngineering

A payment system that does not rely on credit or debit cards, does not require the merchant and purchaser to have compatible memberships to complete a transaction, and does not limit single transactions to a single account provides a wide range of flexibility permitting debit, credit, pre-paid and payroll cards to be accommodated in a seamless and invisible manner to the electronic transaction network. The transaction may be verified and approved at the point-of-sale whether or not the merchant is a member of a specific financial transaction system. Specifically, the point-of-sale transaction system permits an identified customer to use any of a variety of payment options to complete the transaction without requiring the merchant to pre-approve the type of payment selected by the customer. In one configuration, and in order to take advantage of the widespread use of the ATM / POS network, the invention uses a typical credit / debit card format to provide the identifying information in a stored value card. When a transaction is to be completed, the user enters the identifying information carried on the card at the point-of-sale. This can be a merchant or other service provider at a retail establishment, or on-line while the user is logged onto a web site, or other location. The information can be swiped by a card reader, or manually entered via a keyboard or other input device. The system supports a wide range of flexibility, permitting issuing systems such as parents and state welfare agencies to restrict the types of authorized uses, and permitting users to access accounts in a prioritized manner. Further, the accepting merchant is not required to be a member because settlement with the merchant may be made via the Federal Reserve Automatic Clearing House (ACH) system by typical and standard electronic transfer. This permits the merchant to take advantage of the lower ACH transaction fees with even greater convenience and flexibility than the current ATM / POS system. The system supports numerous types of identification methods from typical credit card structures with magnetic data strips to various biometric systems such as finger prints, facial recognition and the like. Specifically, once the user is identified, the transaction is managed by his membership data on record with the transaction processing system.

Owner:ECOMMLINK

Member-supported mobile payment system

InactiveUS8249965B2Low costThe process is simple and fastFinancePayment architectureWireless handheld devicesMobile payment

Owner:OBOPAY MOBILE TECH INDIA PTE LTD

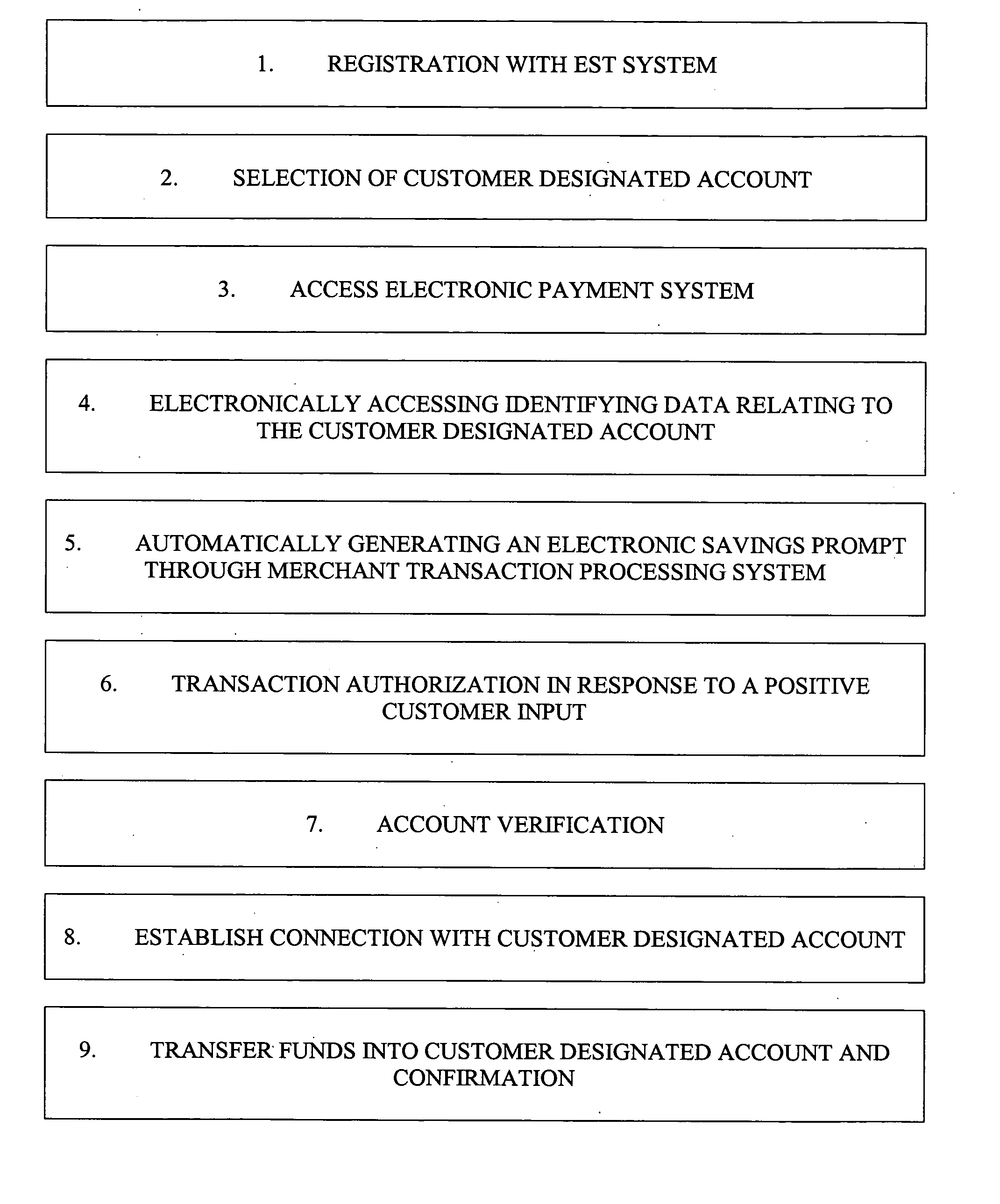

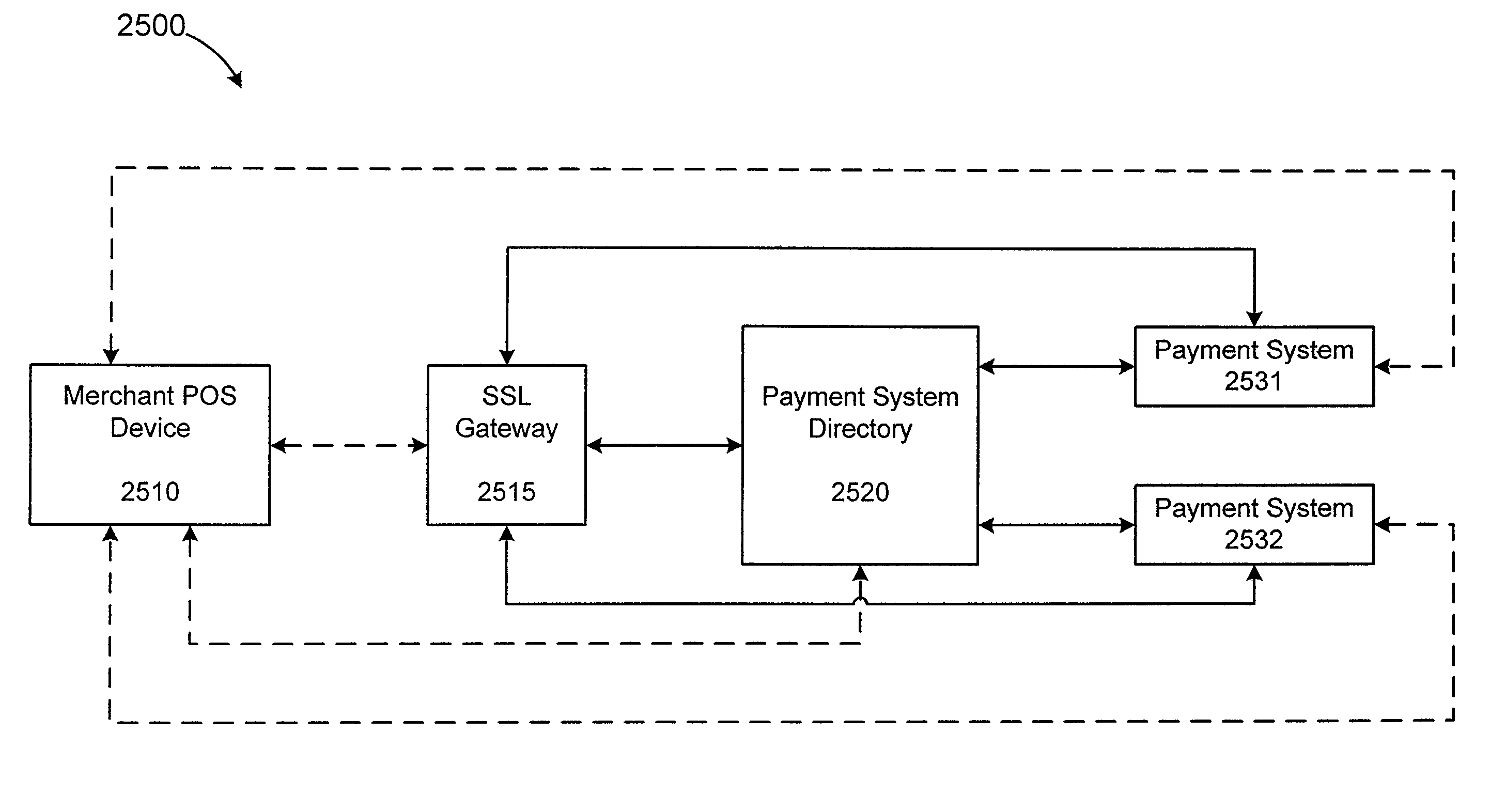

Electronic savings transfers

A system and method is provided for directing the transfer of funds to a customer designated account at a electronic payment system terminal, the method comprising the steps of: a) establishing a customer designated account capable of being accessed through the transaction processing system associated with a merchant, where the transaction processing system is communicatively linked to the customer designated account; b) accessing identifying data relating to the customer designated account through an electronic payment system terminal communicatively linked to the transaction processing system; c) automatically generating an electronic savings prompt for a customer at the electronic payment system terminal; and d) in response to a positive customer input to the savings prompt establishing a connection to the customer designated account and transferring funds into the customer designated account.

Owner:HYBRID KIOSKS

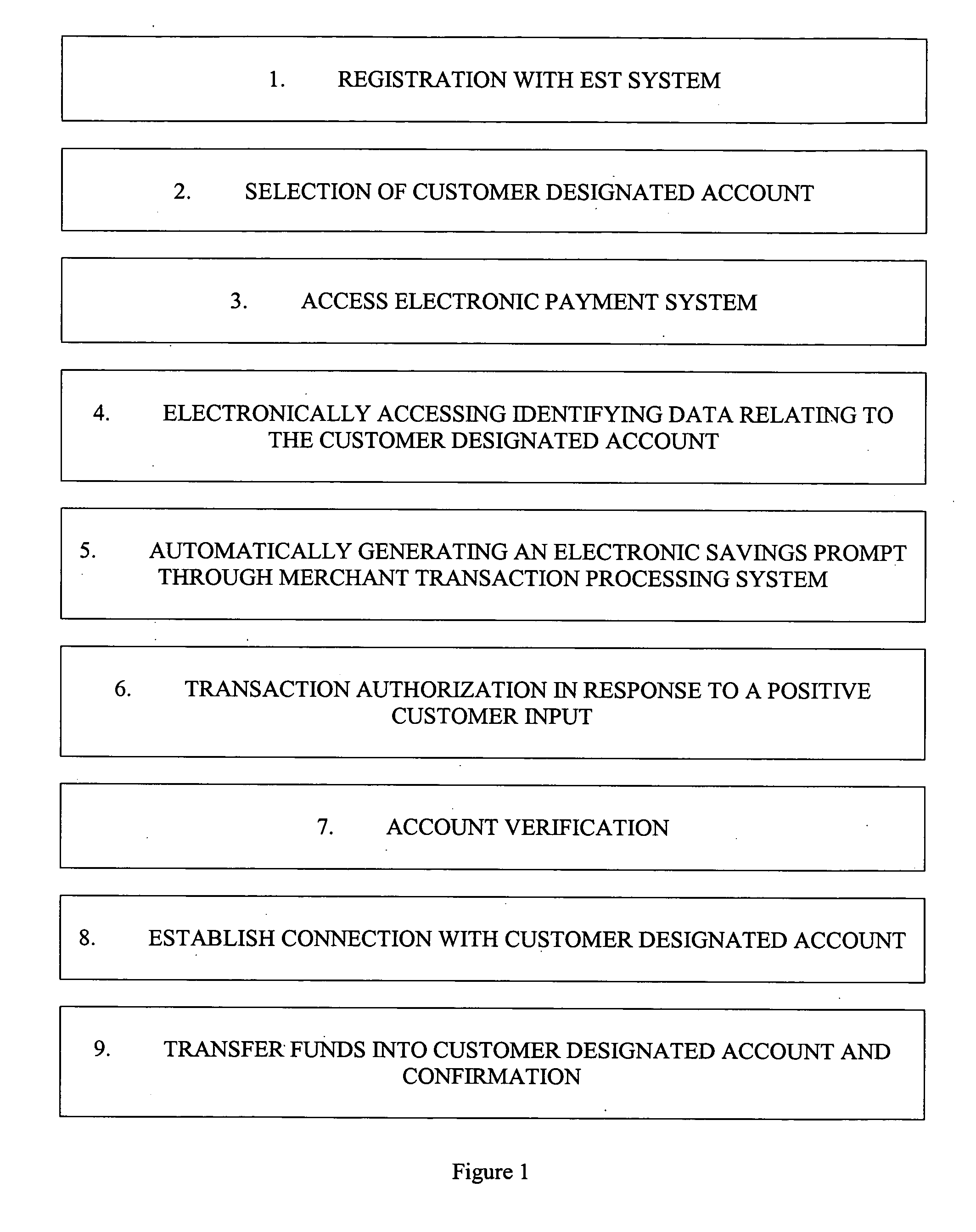

Methods for processing a payment authorization request utilizing a network of point of sale devices

InactiveUS8814039B2Easy to identifyEasy to calculateComplete banking machinesHand manipulated computer devicesThird partyIssuing bank

A point of sale (POS) device may be configured to locate a payment system and transmit a payment authorization request from a remote location to a payment system, either directly, or via a payment system directory and / or a SSL Gateway. The invention also includes inserting third party account information into an encrypted portion of the payment request, so the payment request appears as a normal request to the issuing bank, but the third party account information may be used by the third party to bill the customer. The payment system directory is further configured to determine one or more payment processors to direct a payment authorization request, such that a single transaction may me allocated among multiple payment processors for authorization. Moreover, the payment system directory is able to format alternative payment methods into a format that is able to be processed over existing payment networks.

Owner:LIBERTY PEAK VENTURES LLC

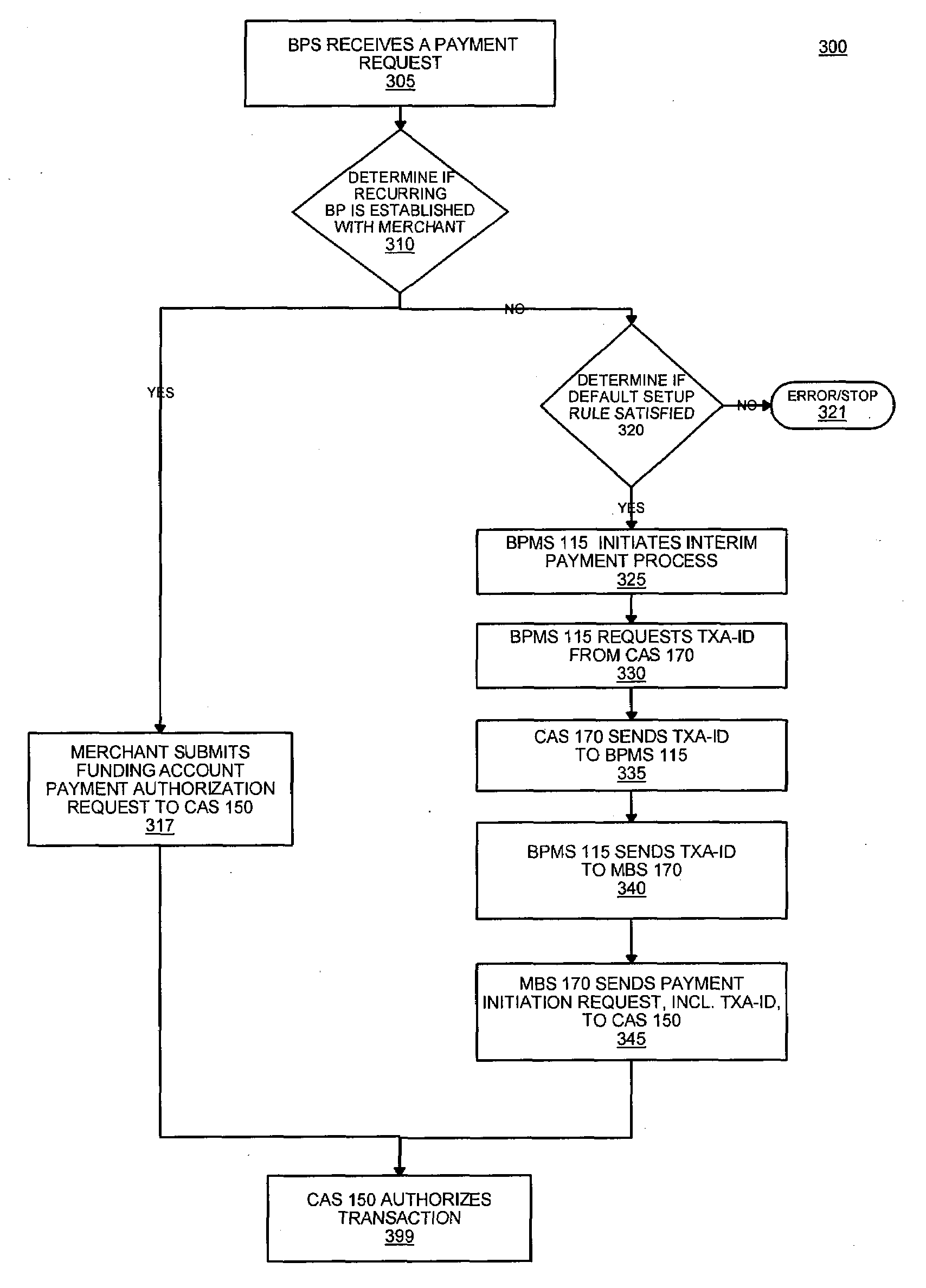

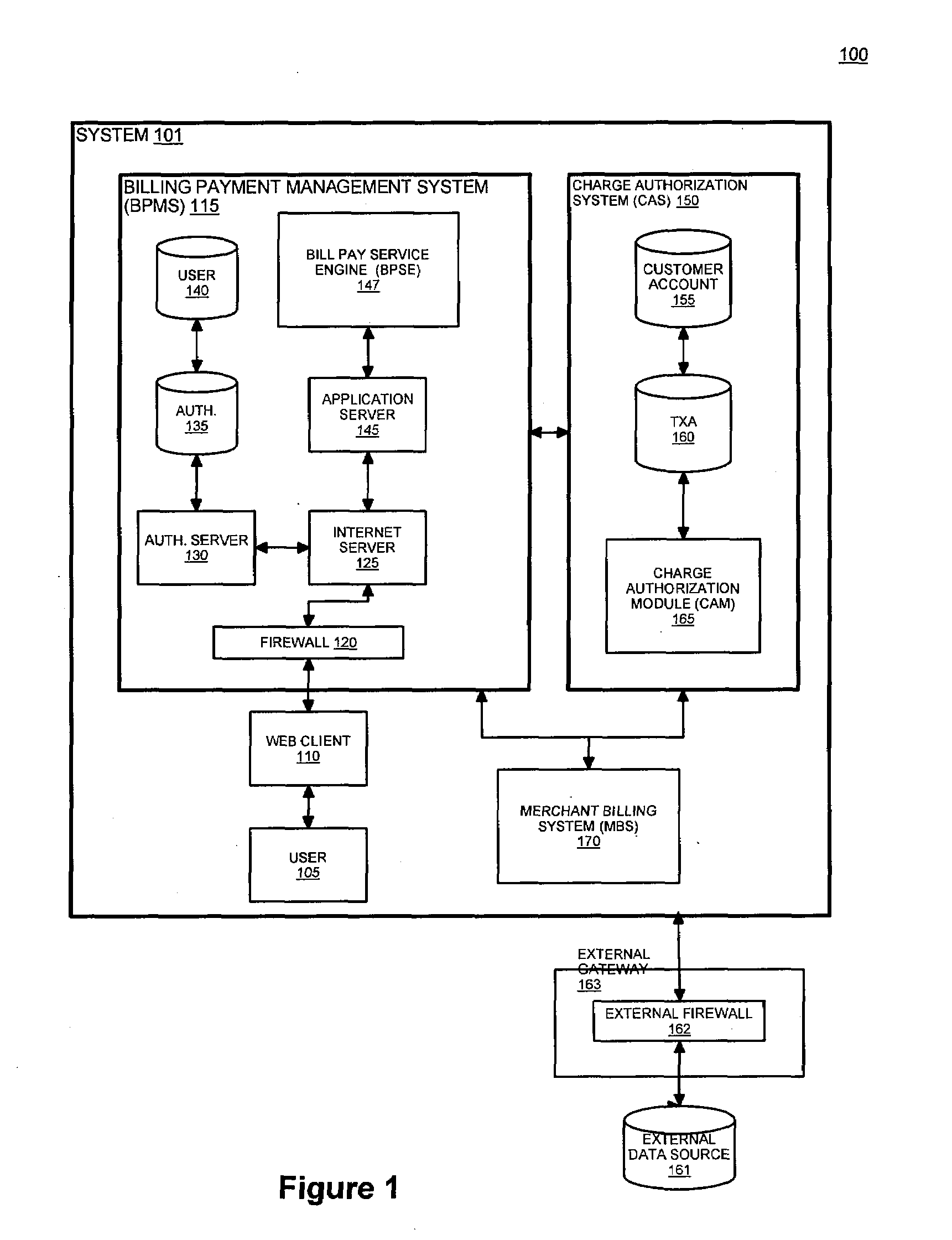

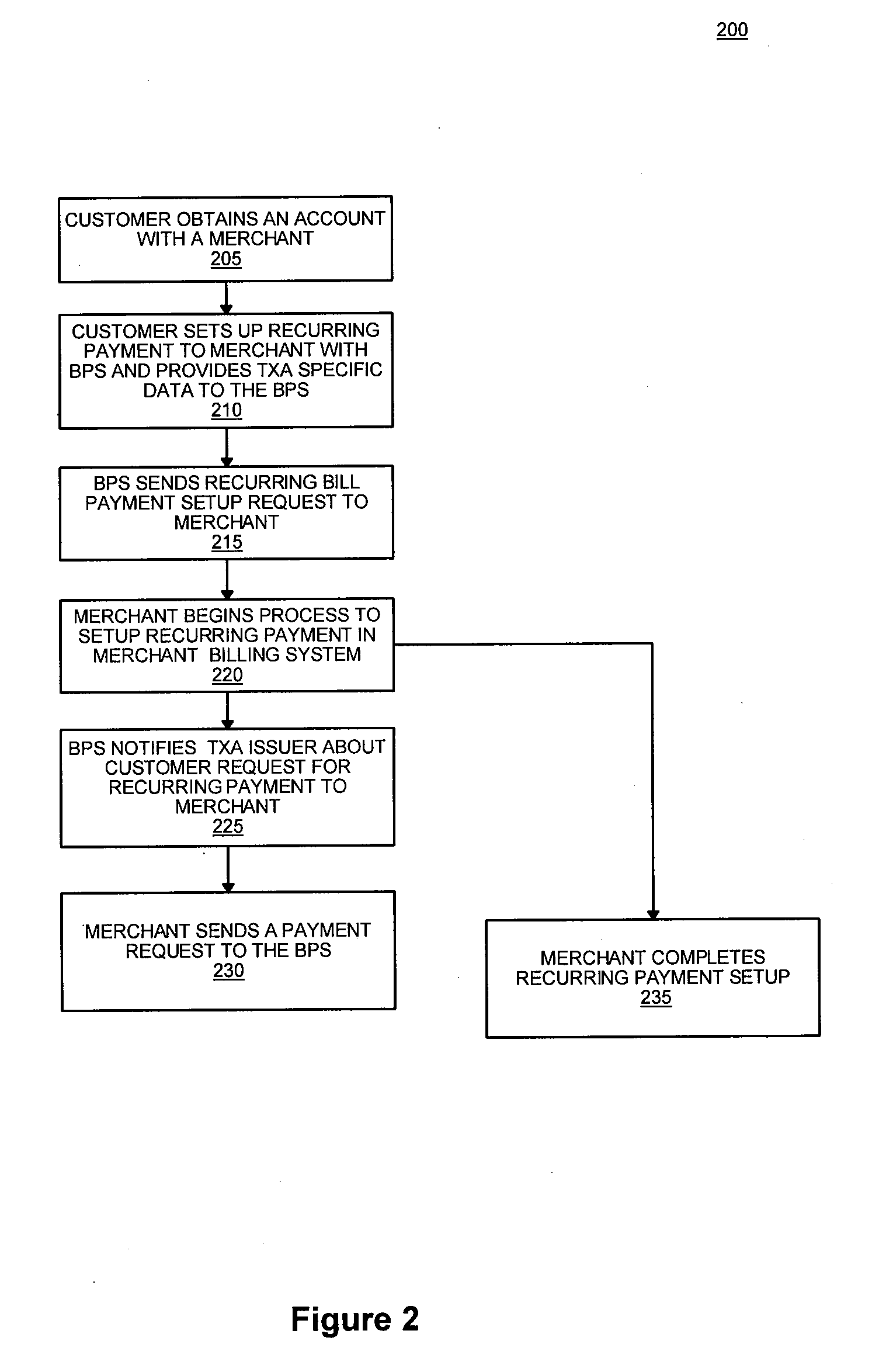

Bill payment system and method

Automated authorization and processing of an interim payment is disclosed. When a merchant requests payment prior to a recurring payment process being enabled, the system handles the payment request without customer intervention. The system requests and receives a transaction coordination code for an interim payment from a financial processor. The system passes the interim payment transaction coordination code to the merchant so the merchant may obtain an authorized payment.

Owner:LIBERTY PEAK VENTURES LLC

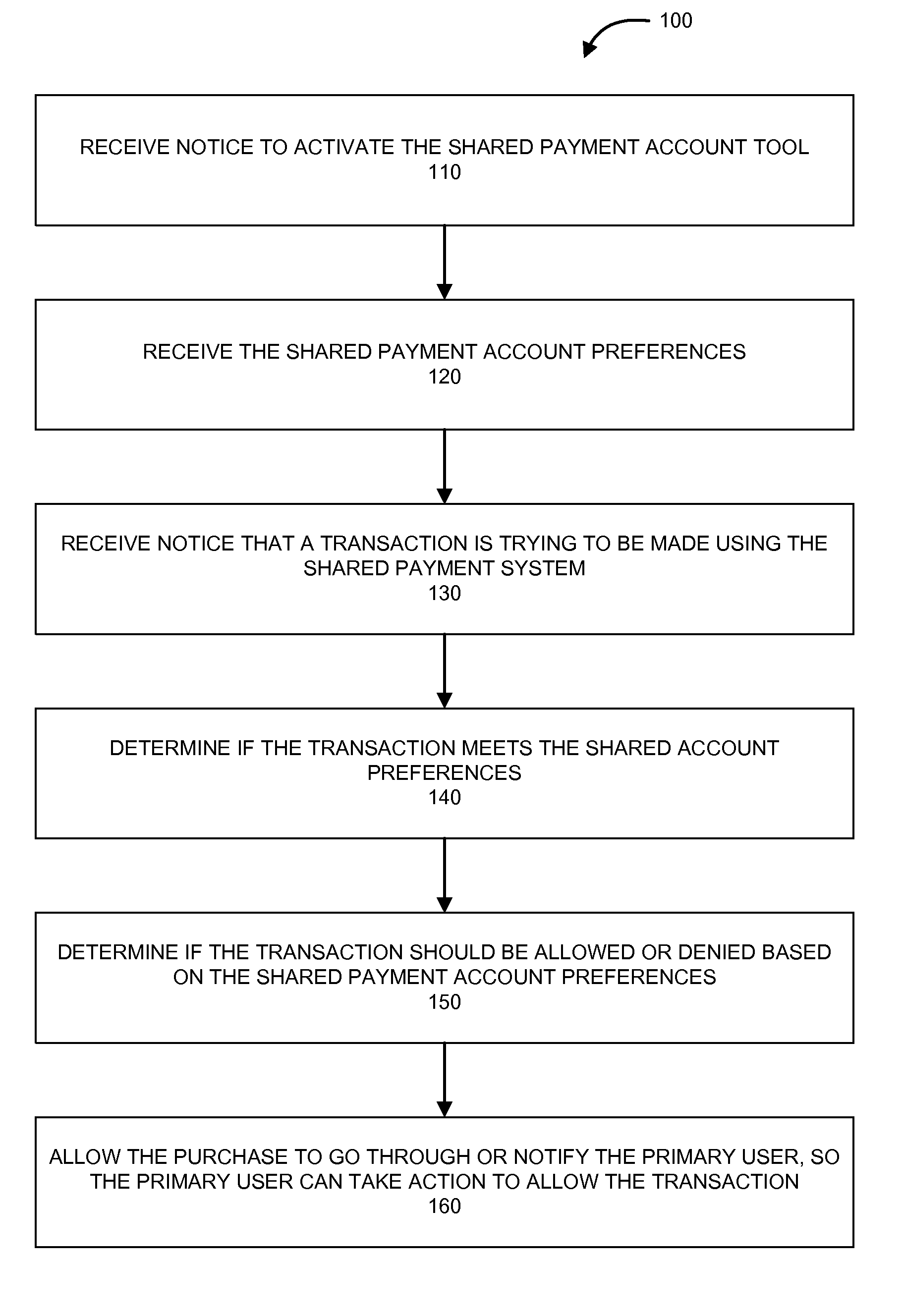

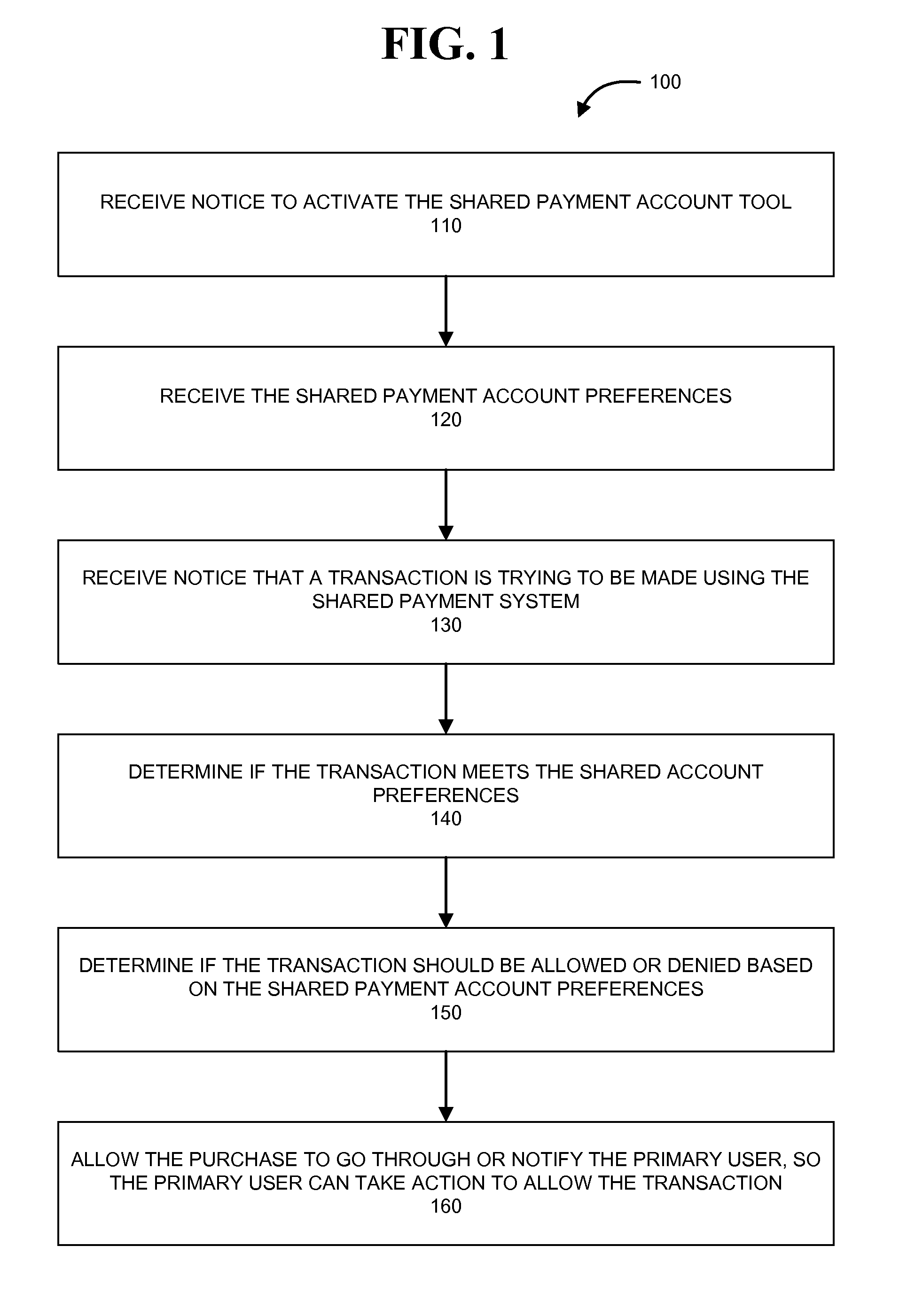

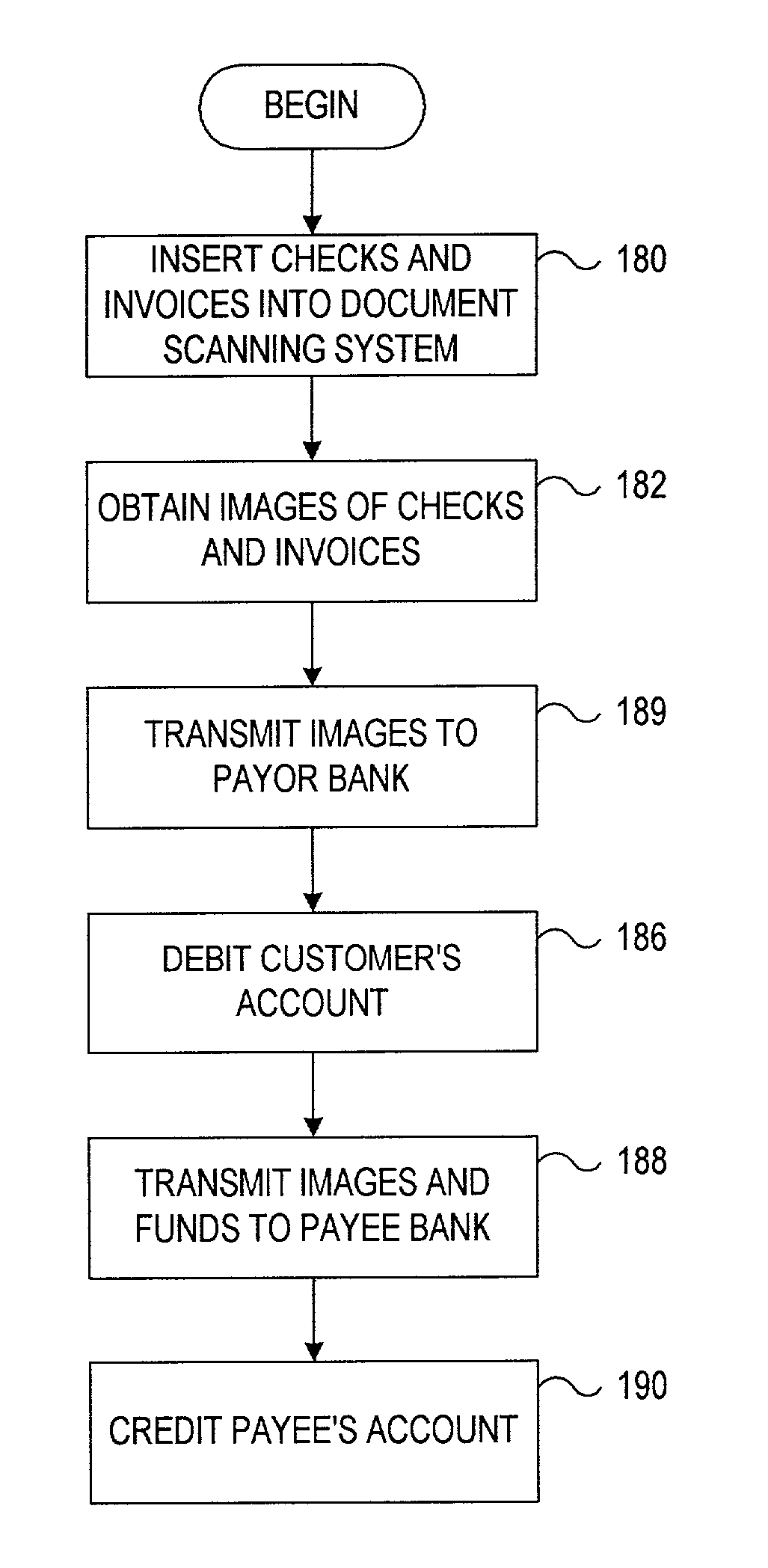

Shared mobile wallet

The present invention provides embodiments of a shared account system that allows a primary user to add one or more dependent users to one or more accounts of the primary user in order to control and monitor the transactions made by a dependent user using a shared payment system. The primary user can set preferences, including spending limits, specific time frames within which the dependent user can make a purchase, or restrictions on transactions made at a store or for a product. The shared payment system may be a shared mobile wallet, such as a smartphone or PDA, which allows a user to enter into transactions. The shared mobile wallet allows the dependent user to make a purchase at a store or over a network by transmitting through a connection between the shared payment system and the merchant systems used to make the transaction.

Owner:BANK OF AMERICA CORP

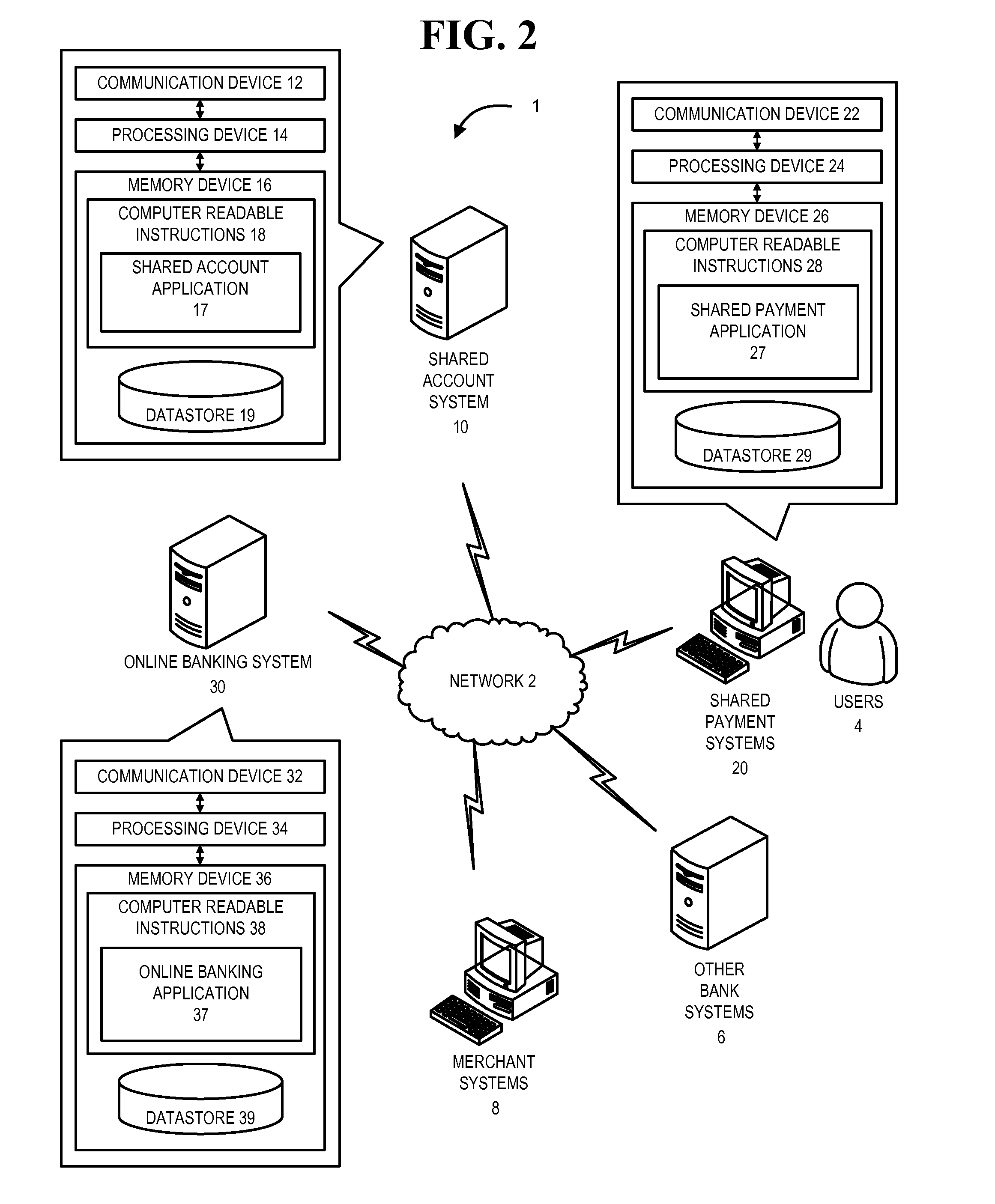

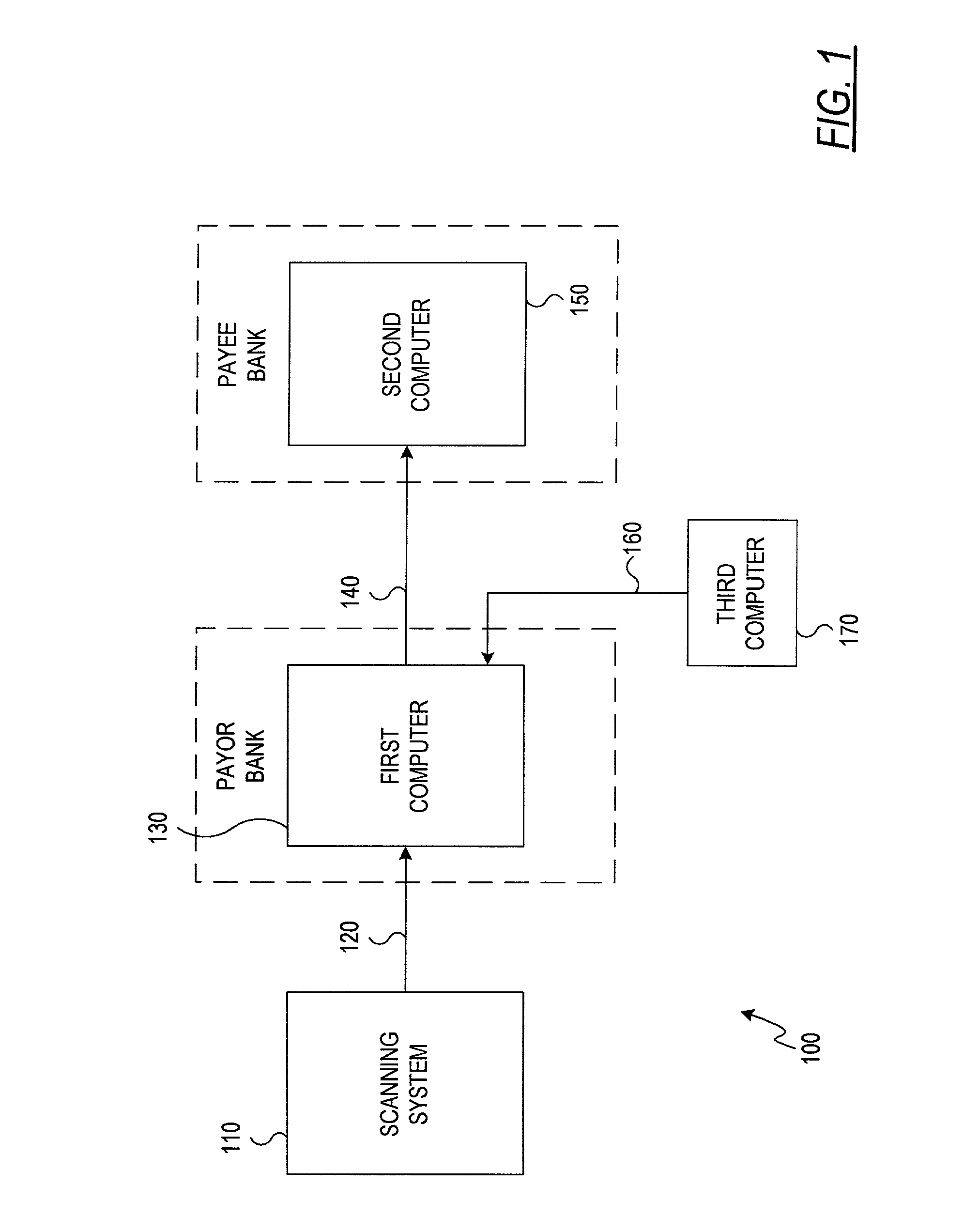

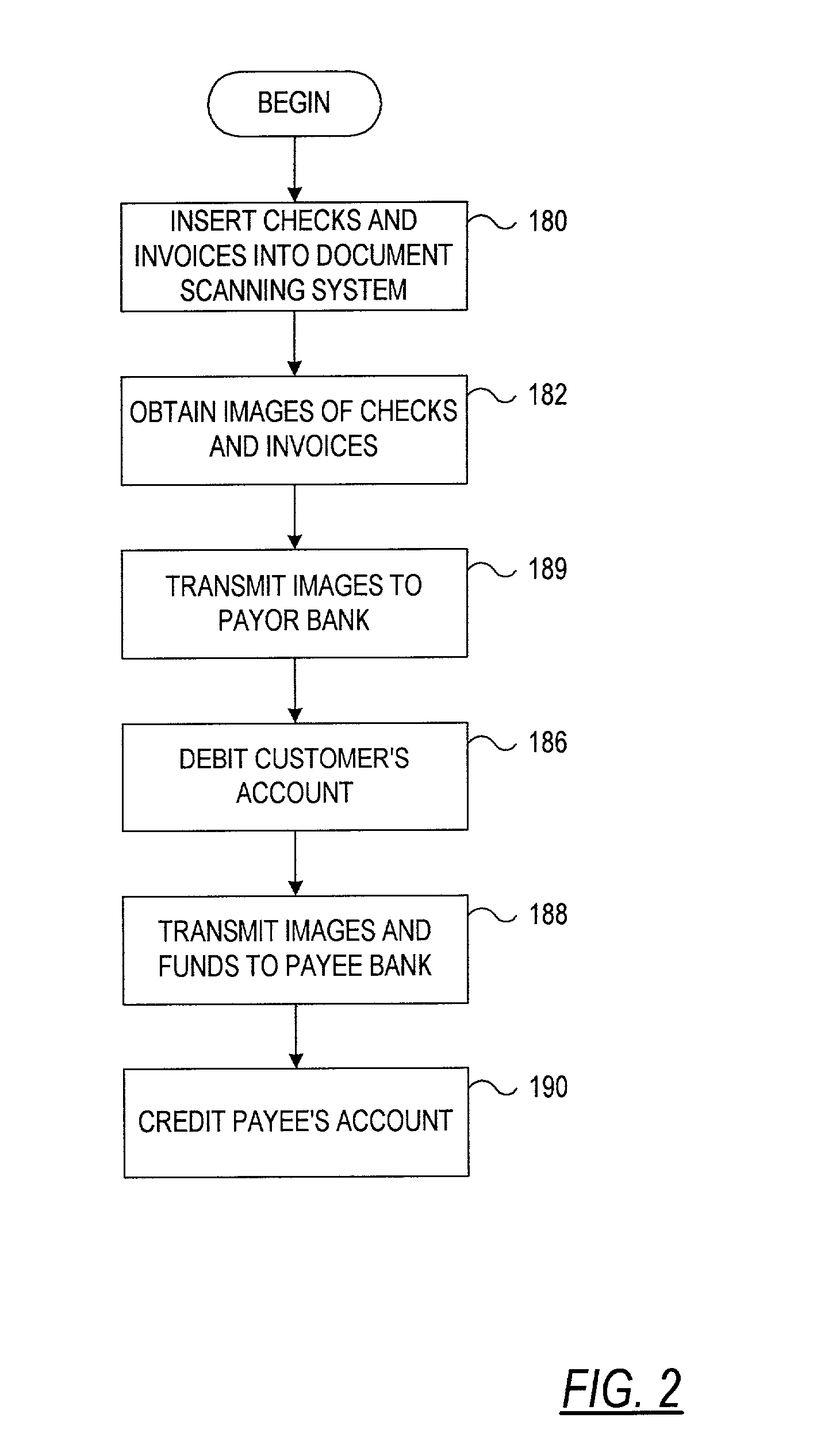

Automated payment system and method

An automated payment system for processing payment by a customer to a company. The payment system includes a document scanning system which has an input receptacle adapted to accept a document. After receiving an authorization agreement from the customer, the scanner acquires at least one image from the document. Also provided is a first computer adapted to receive images from the document scanning system. Adapted to communicate information represented by the image, a first communication link couples the document scanning system and the first computer. The payment system also includes a second computer adapted to receive images which is in communication with the first computer via a second communication link. The second communication link is adapted to communicate images and payment information.

Owner:CUMMINS-ALLISON CORP

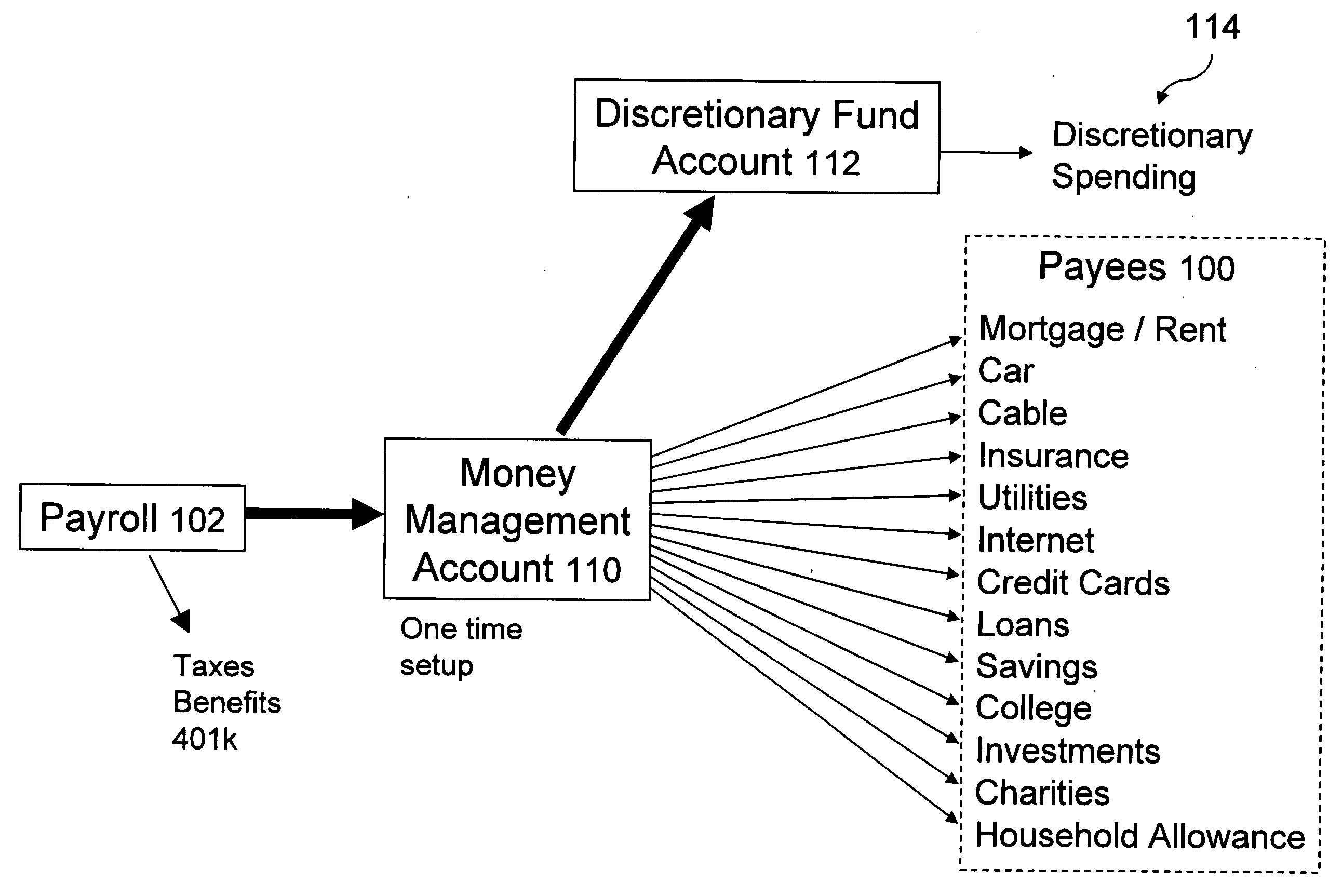

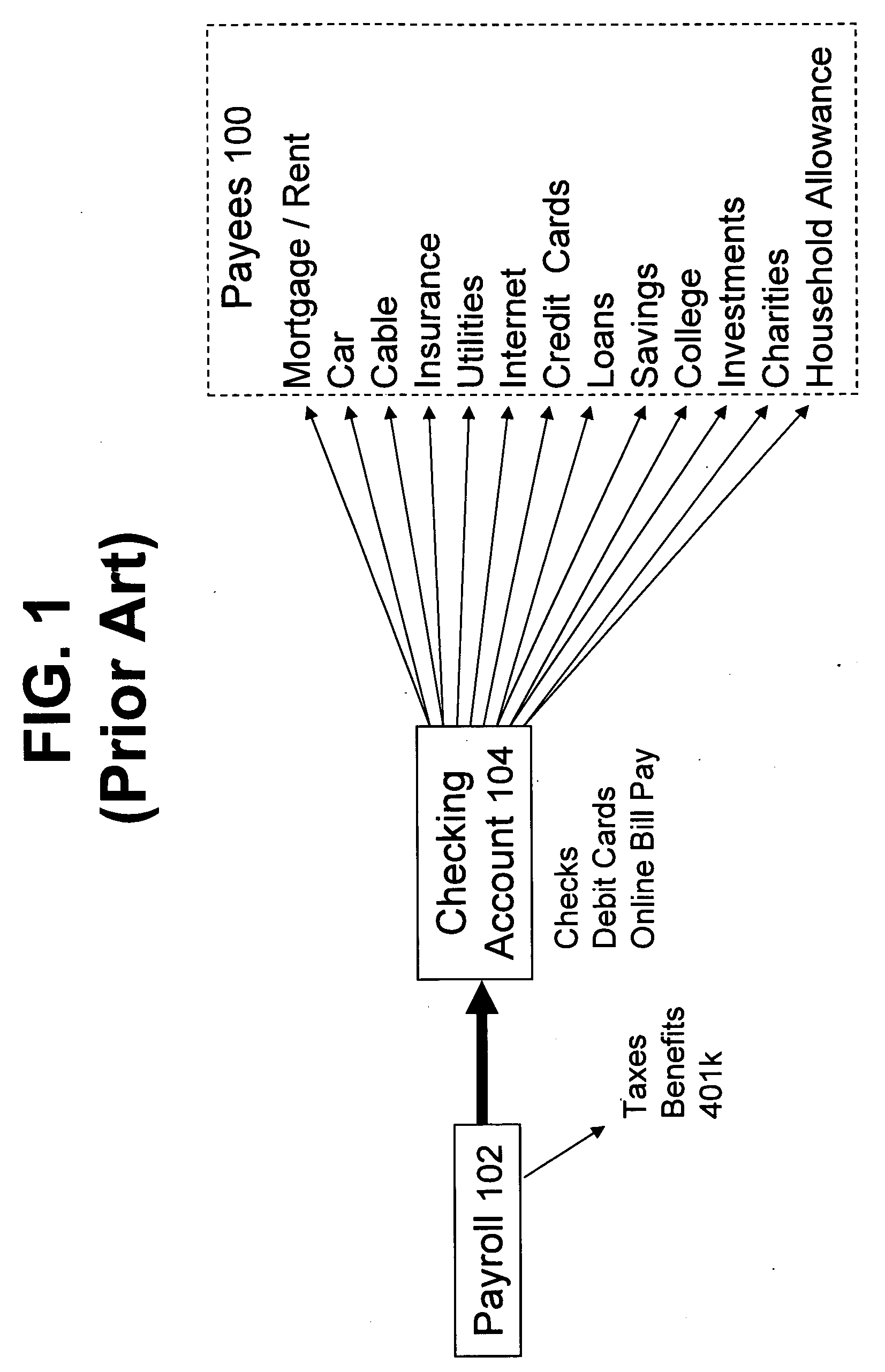

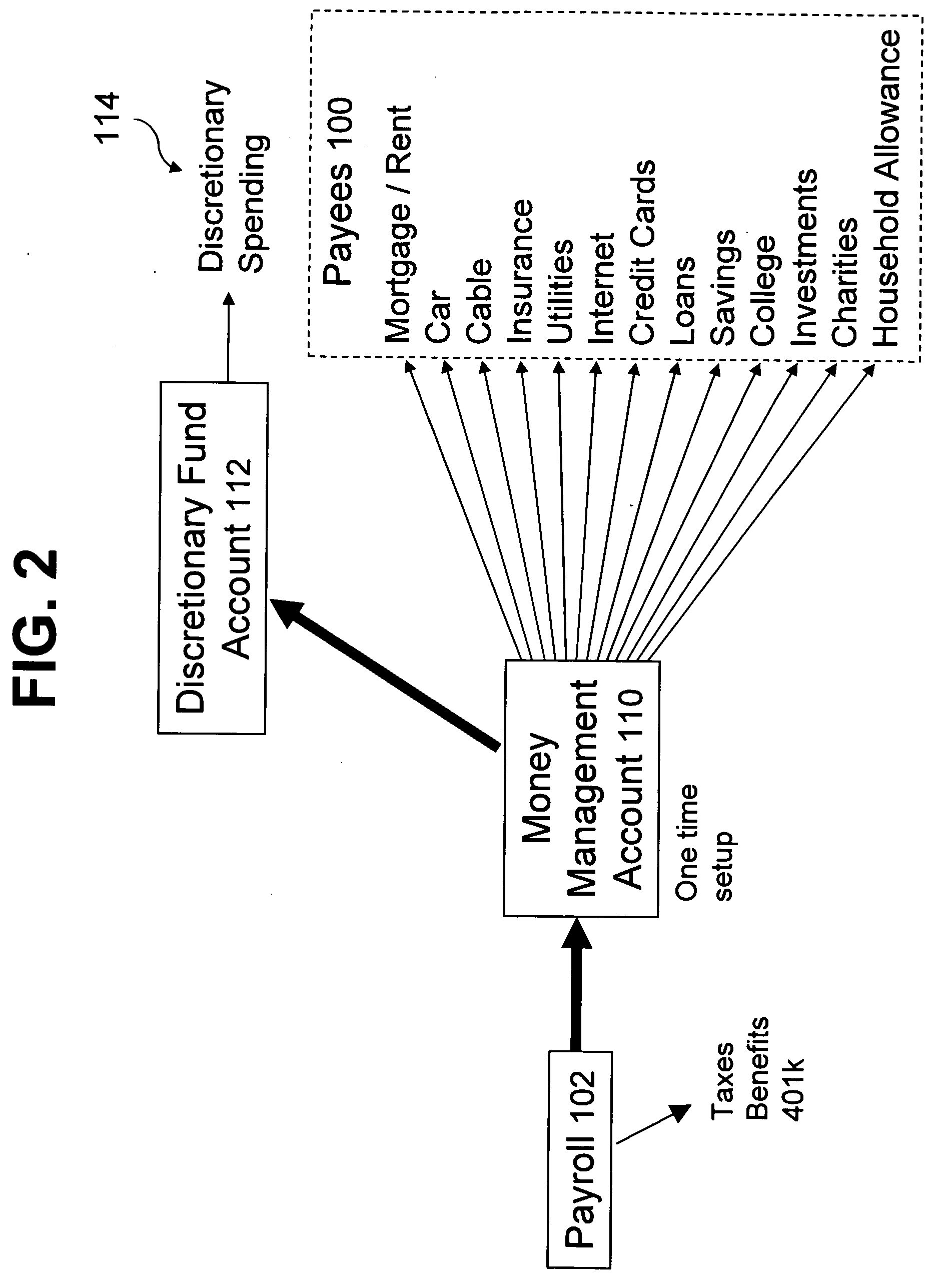

Payment system and method

Using a single source money management system customers may automate their committed spending. A money management account and a discretionary fund account are established in response to a customer's request to participate in the system. A financial institution receives money on a periodic basis from a customer's predictable payment system. The money is then deposited / transferred to the money management account, retained in the money management account as required for bill payment, and / or deposited / transferred into the discretionary fund account if it is “excess.” Bills are paid on a customer determined schedule directly from the money management account using the money retained in the money management account. A loan account may also be established in response to a customer's application for a loan account. A financial institution grants a loan for a loan purchase in response to a customer's application for a loan purchase. The system and / or the financial institution handles payment for the loan purchase and repayment of the loan from the loan account from the money management account. The present invention may include a secure internet shopping system that includes a vendor web system and a financial institution web system. Each vendor offers goods and / or services. The financial institution web system permits customer authorization of payment to a selected vendor.

Owner:LINDSAY BROWN NICHOLAS ANTHONY

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com