Patents

Literature

295 results about "Issuing bank" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

An issuing bank is a bank that offers card association branded payment cards directly to consumers, such as credit cards, debit cards and prepaid cards. The name is derived from the practice of issuing cards to a consumer.

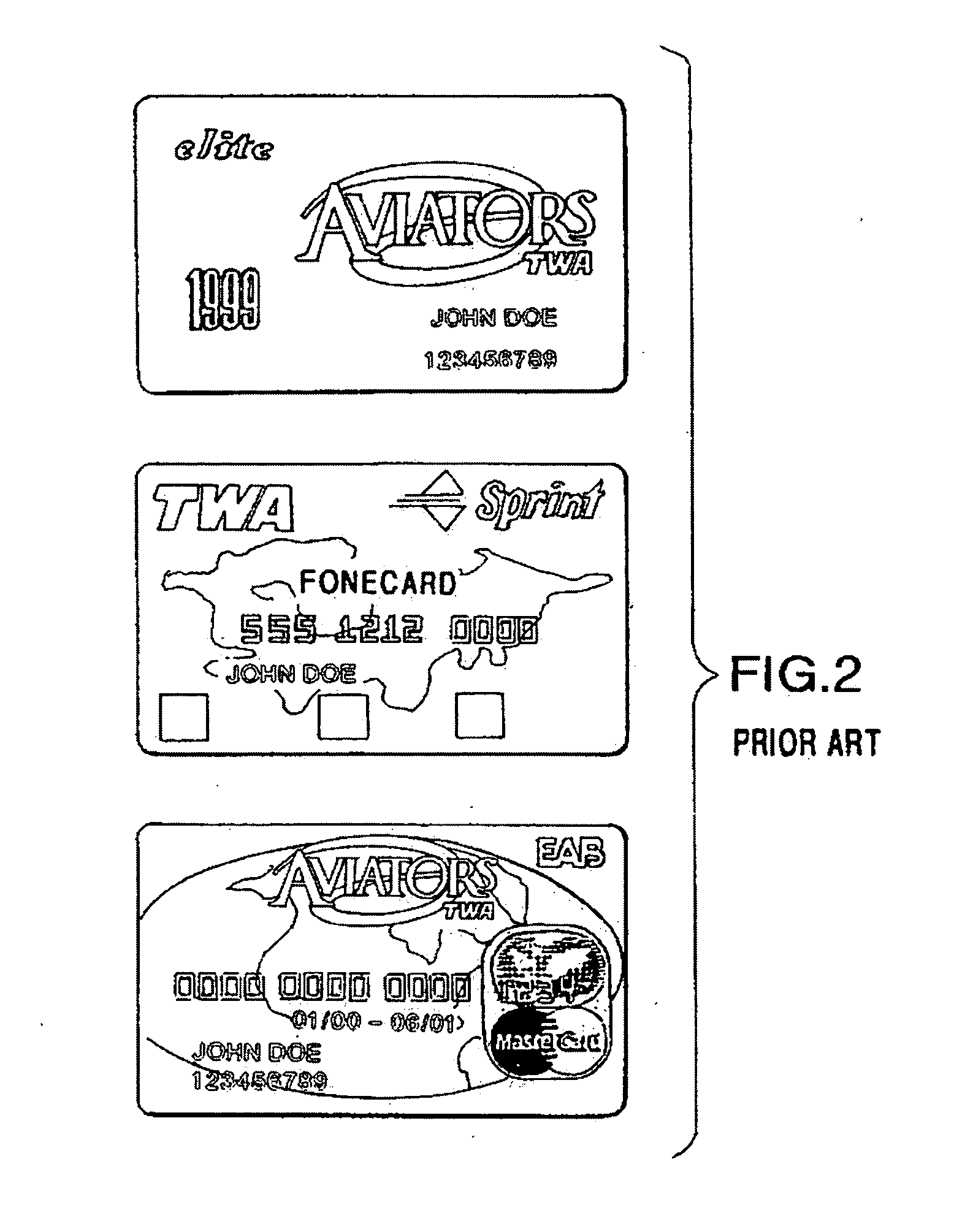

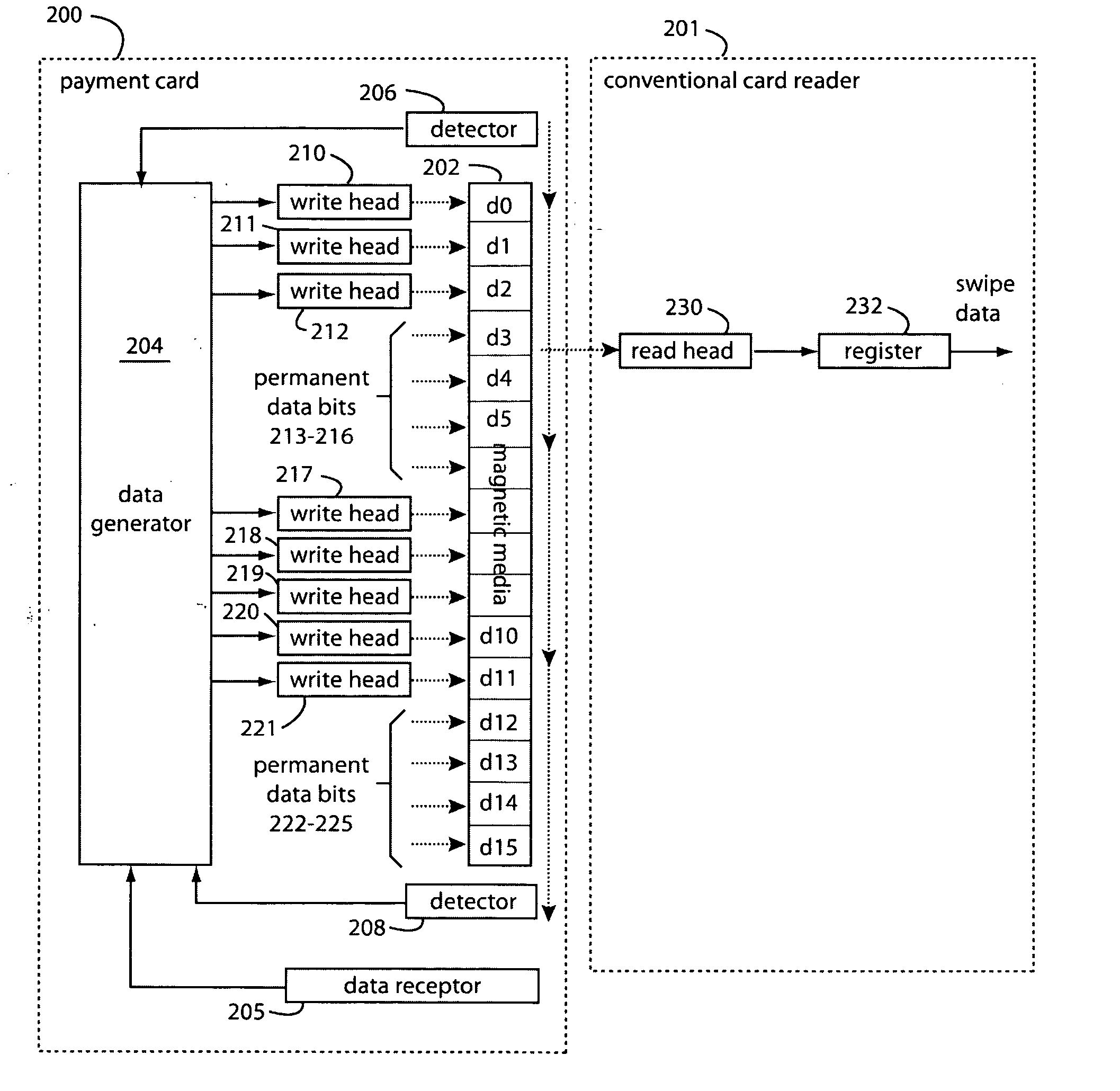

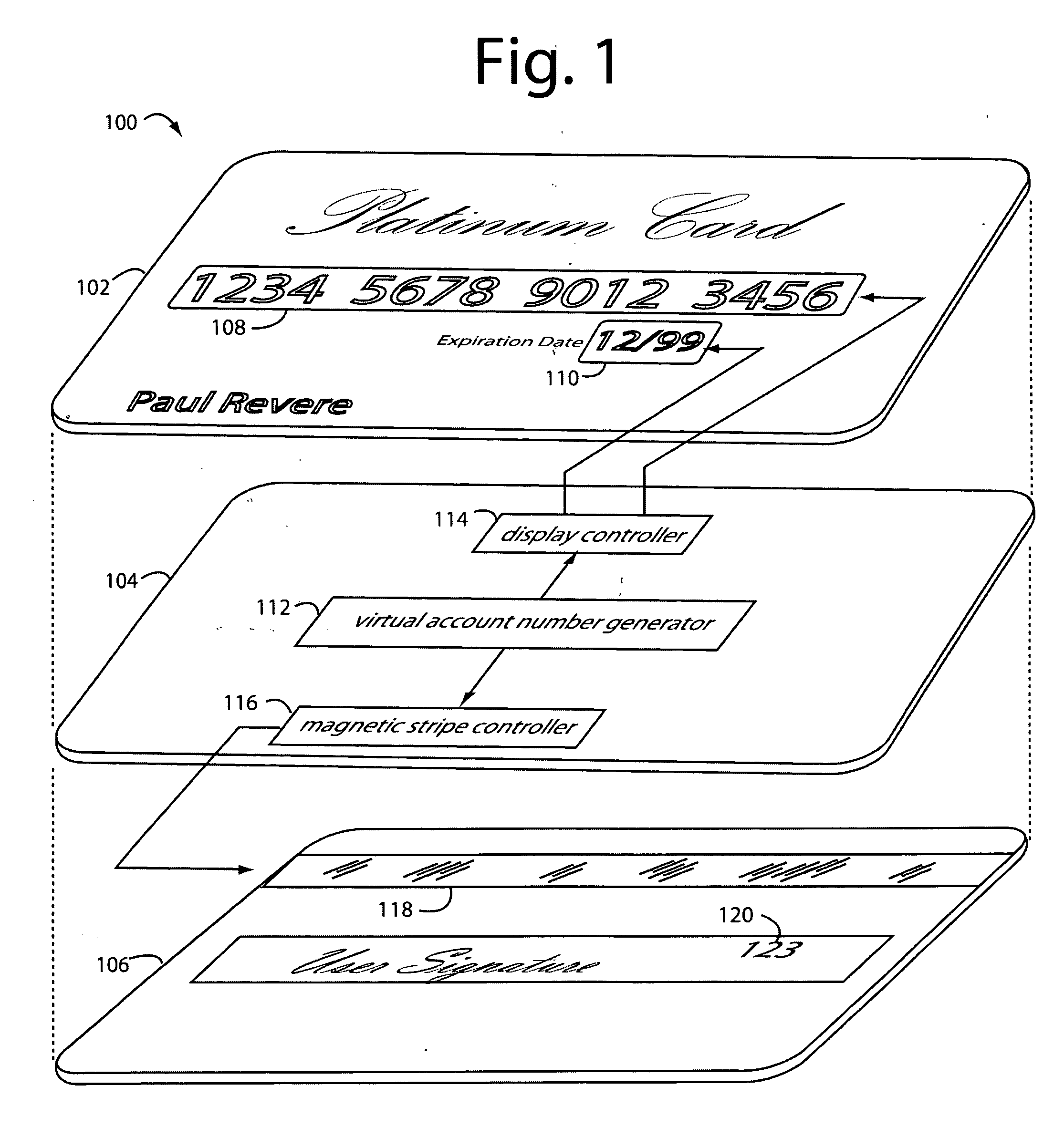

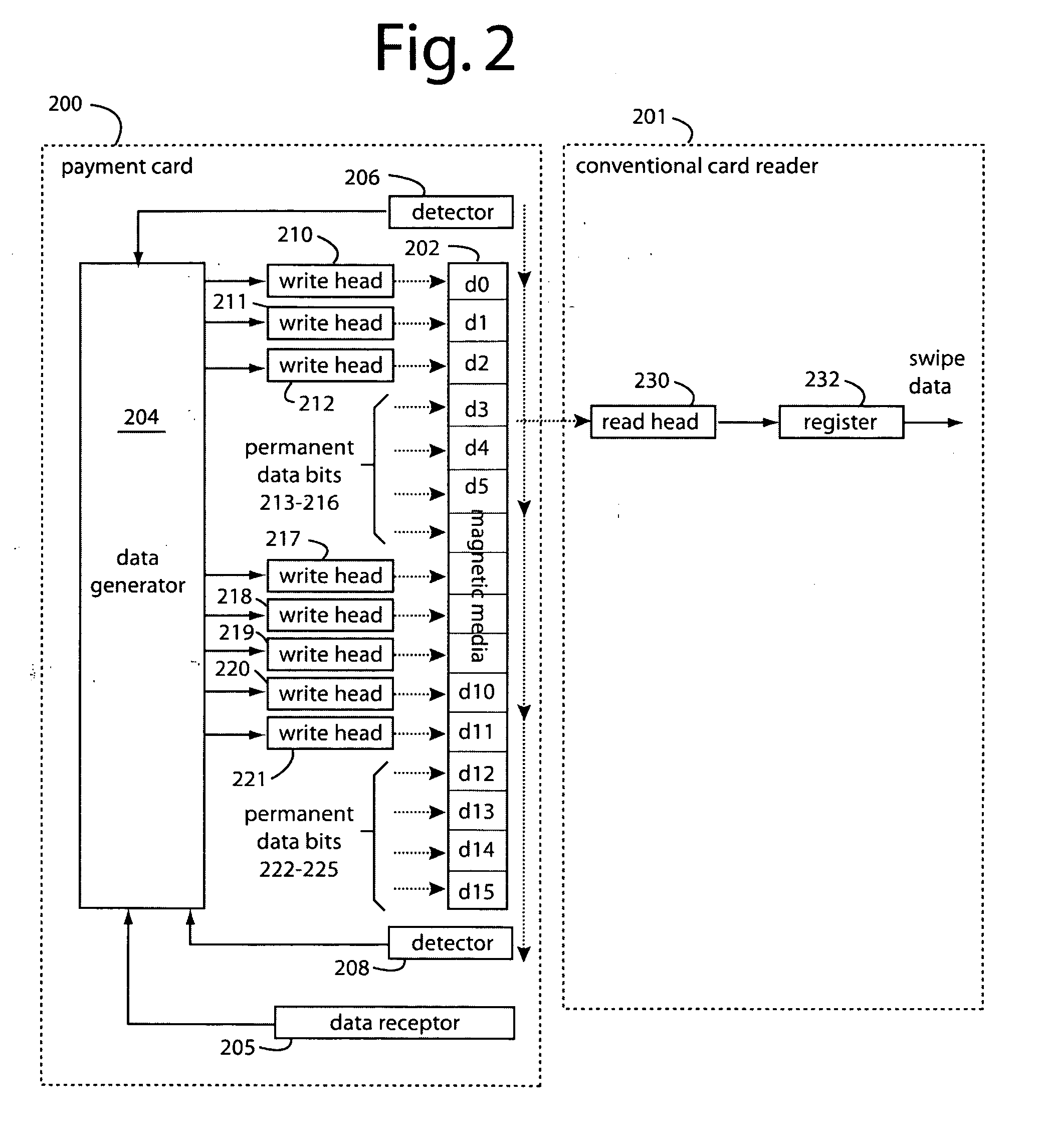

Payment card with internally generated virtual account numbers for its magnetic stripe encoder and user display

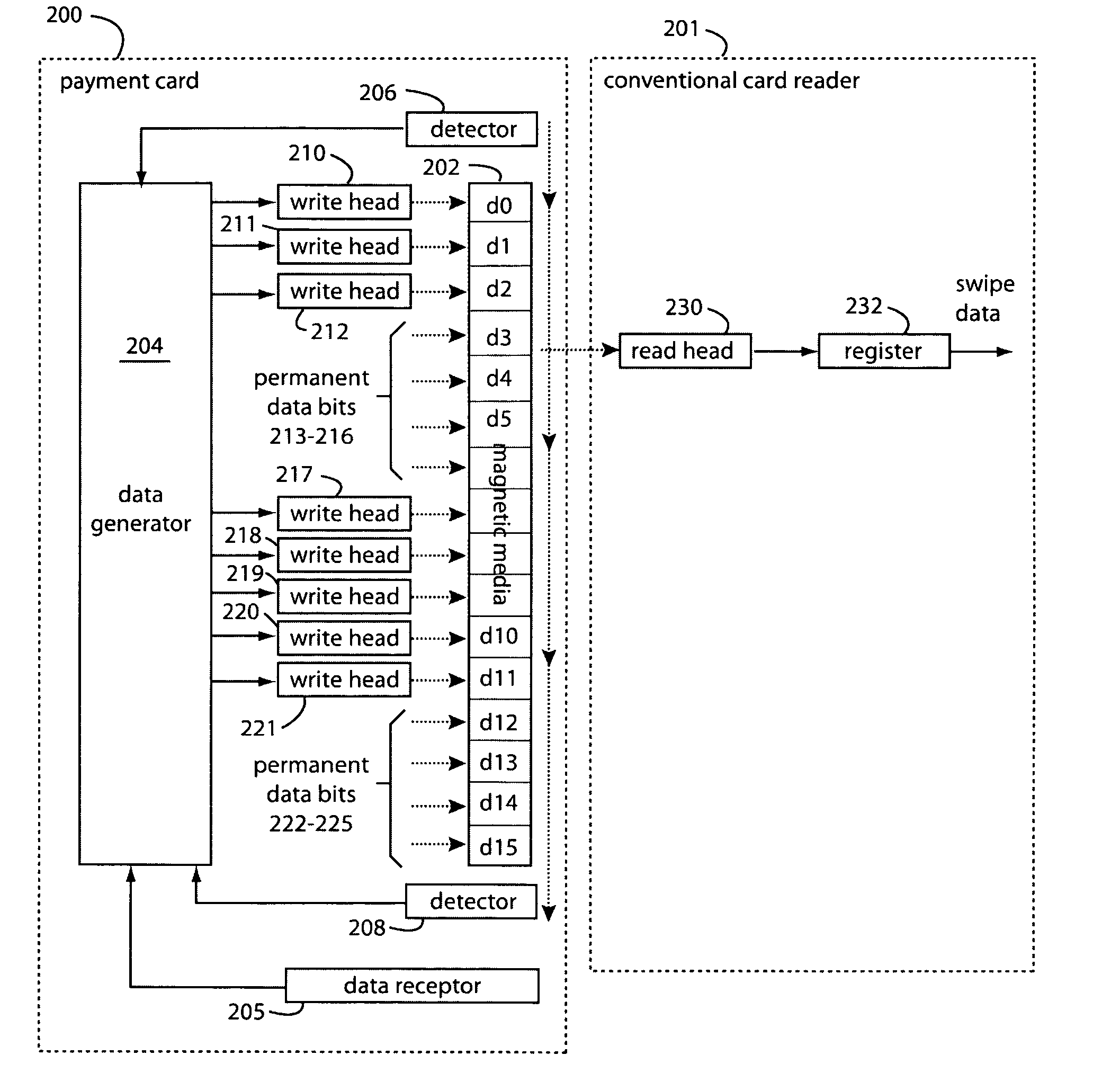

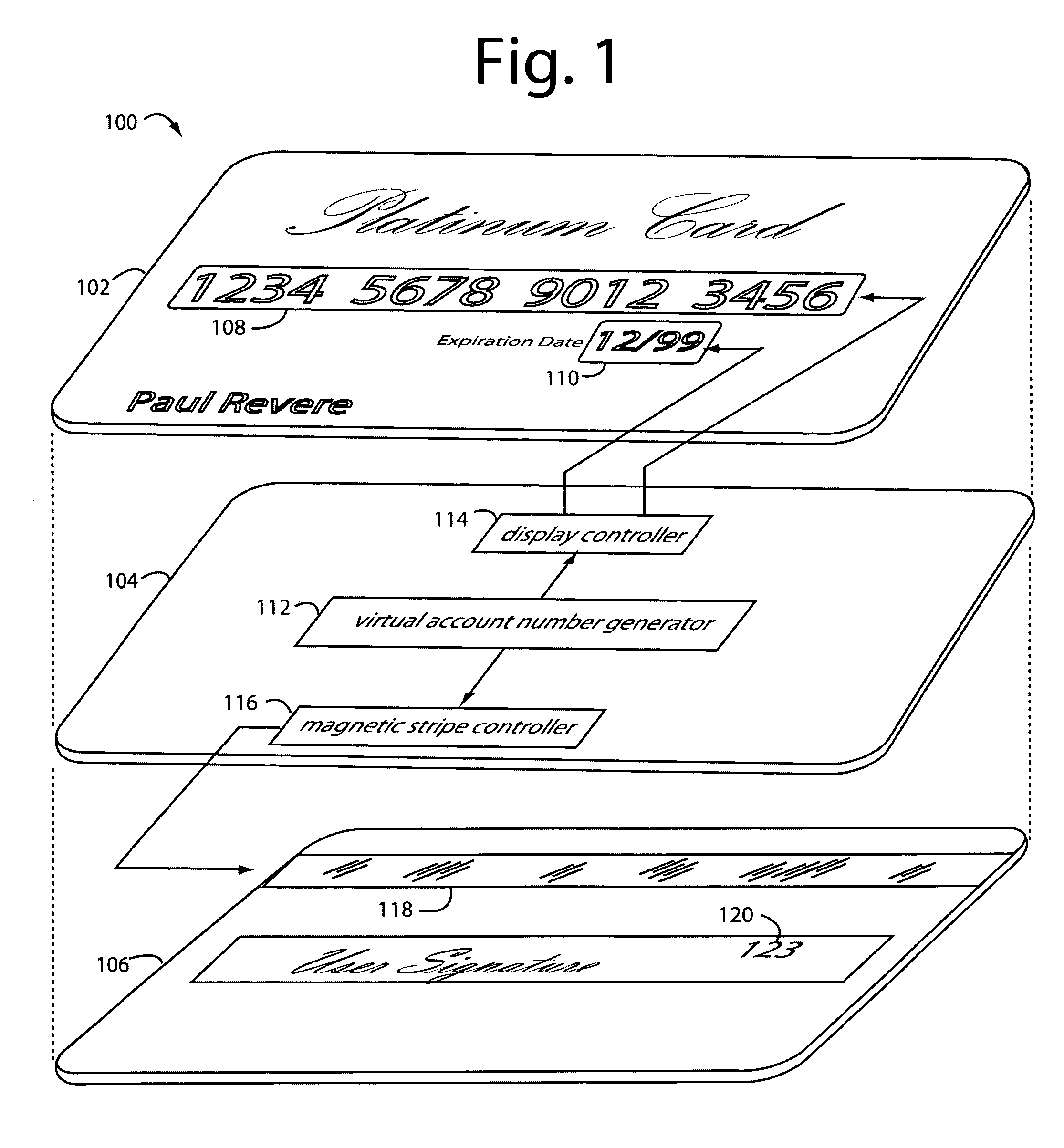

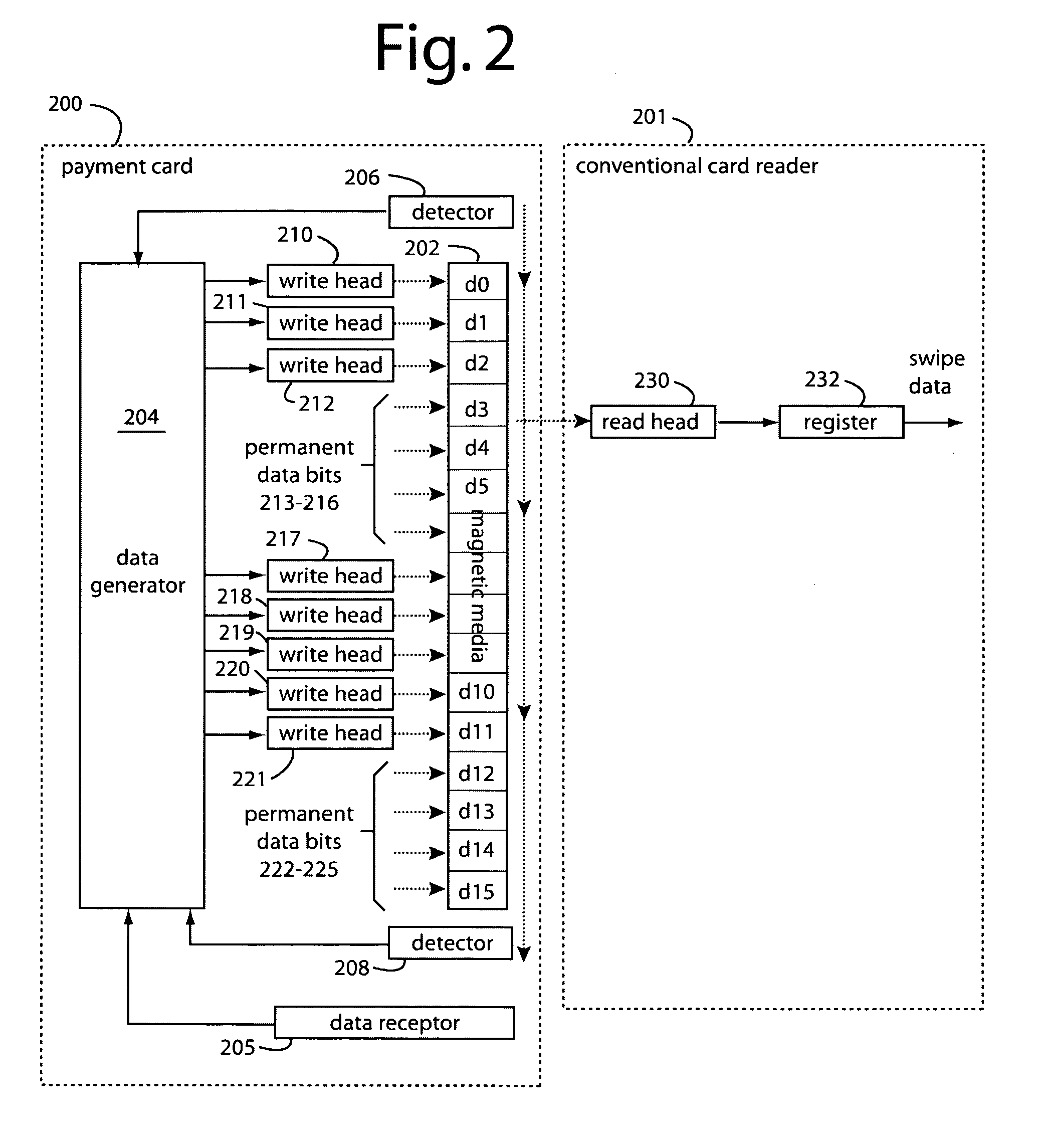

A payment card comprises an internal virtual account number generator and a user display for online transactions. Offline transactions with merchant card readers are enabled by a magnetic array positioned behind the card's magnetic stripe on the back. The internal virtual account number generator is able to program the magnetic bits encoded in the magnetic stripe to reflect the latest virtual account number. The internal virtual account number generator produces a sequence of virtual numbers that can be predicted and approved by the issuing bank. Once a number is used, it is discarded and put on an exclusion list.

Owner:FITBIT INC

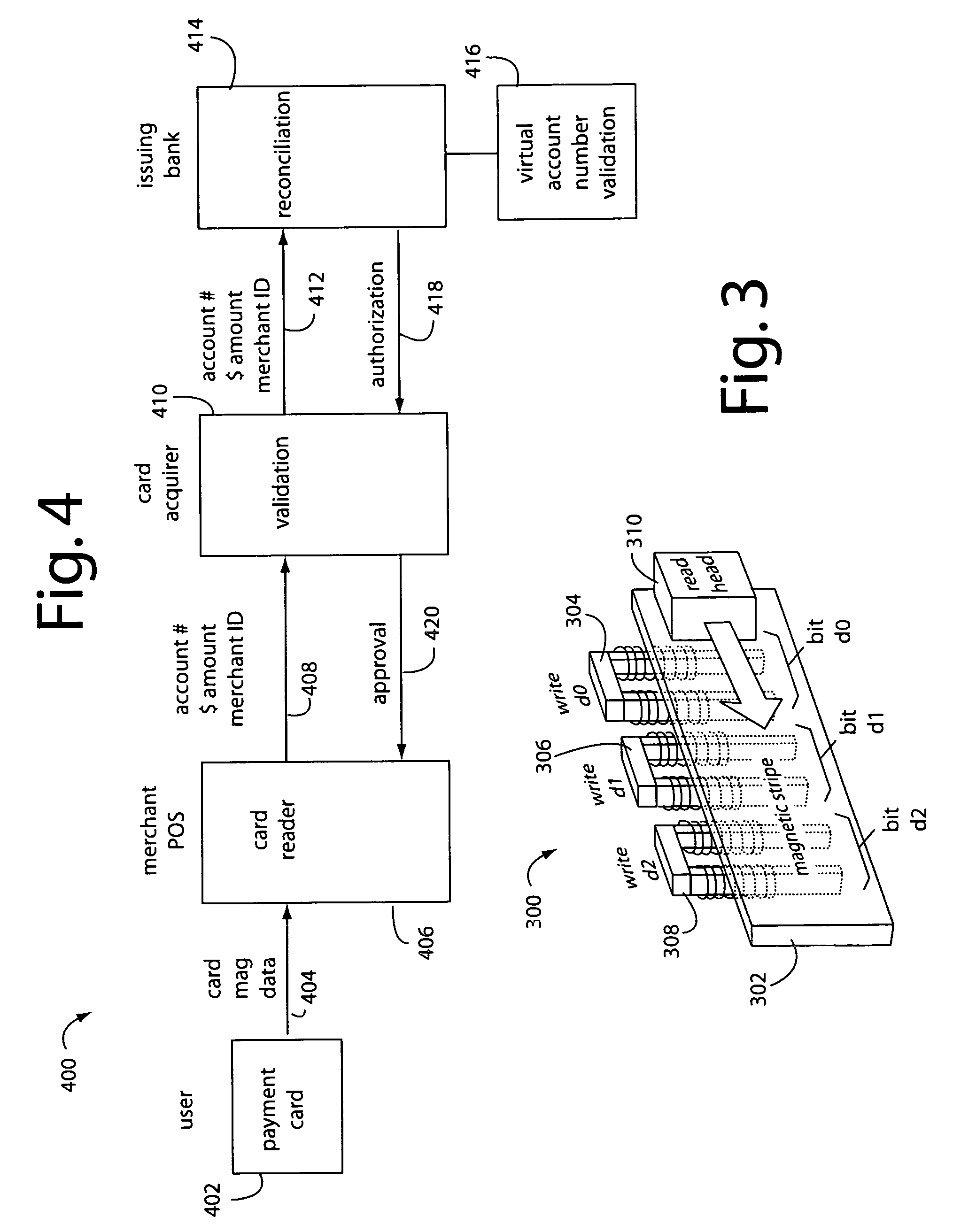

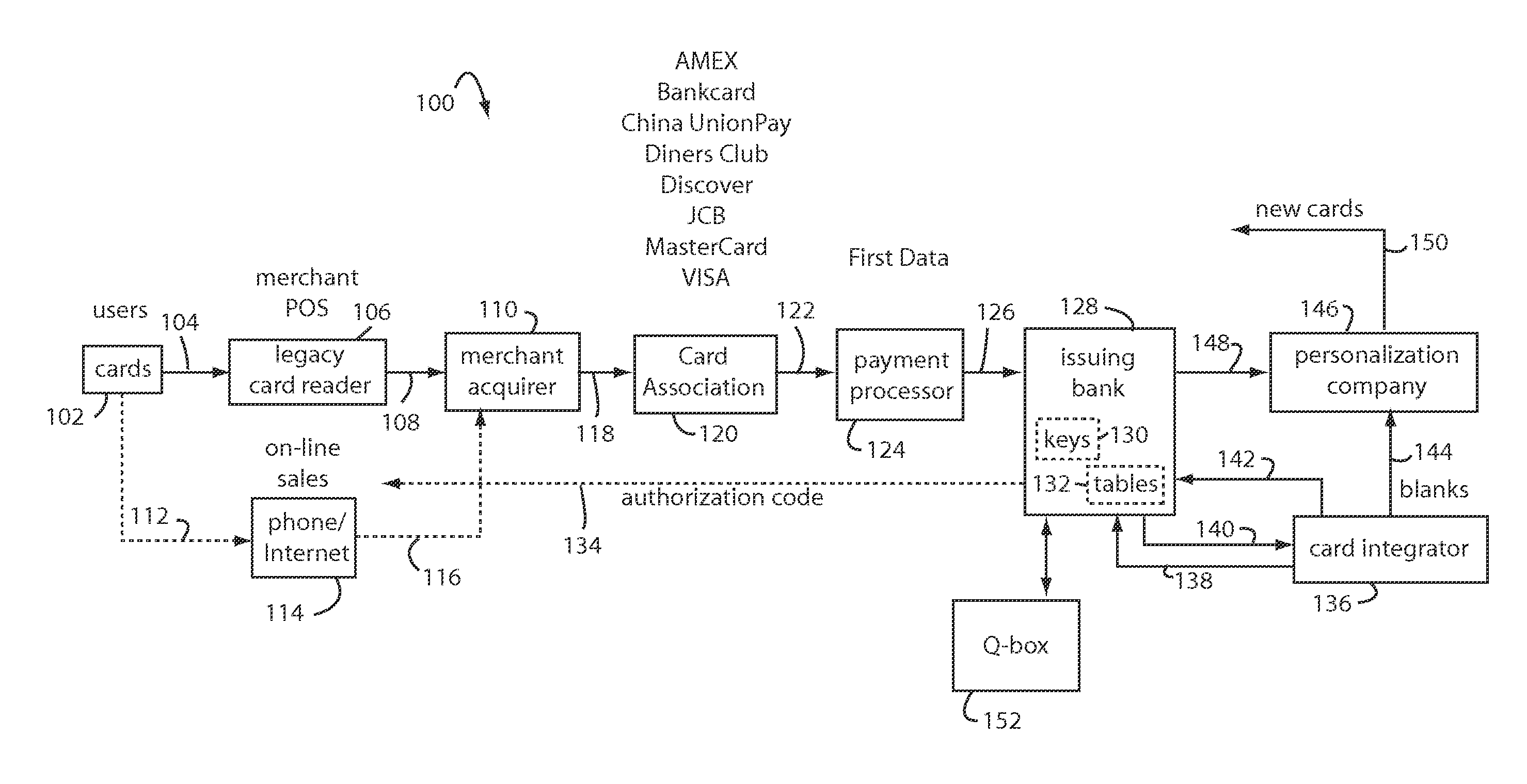

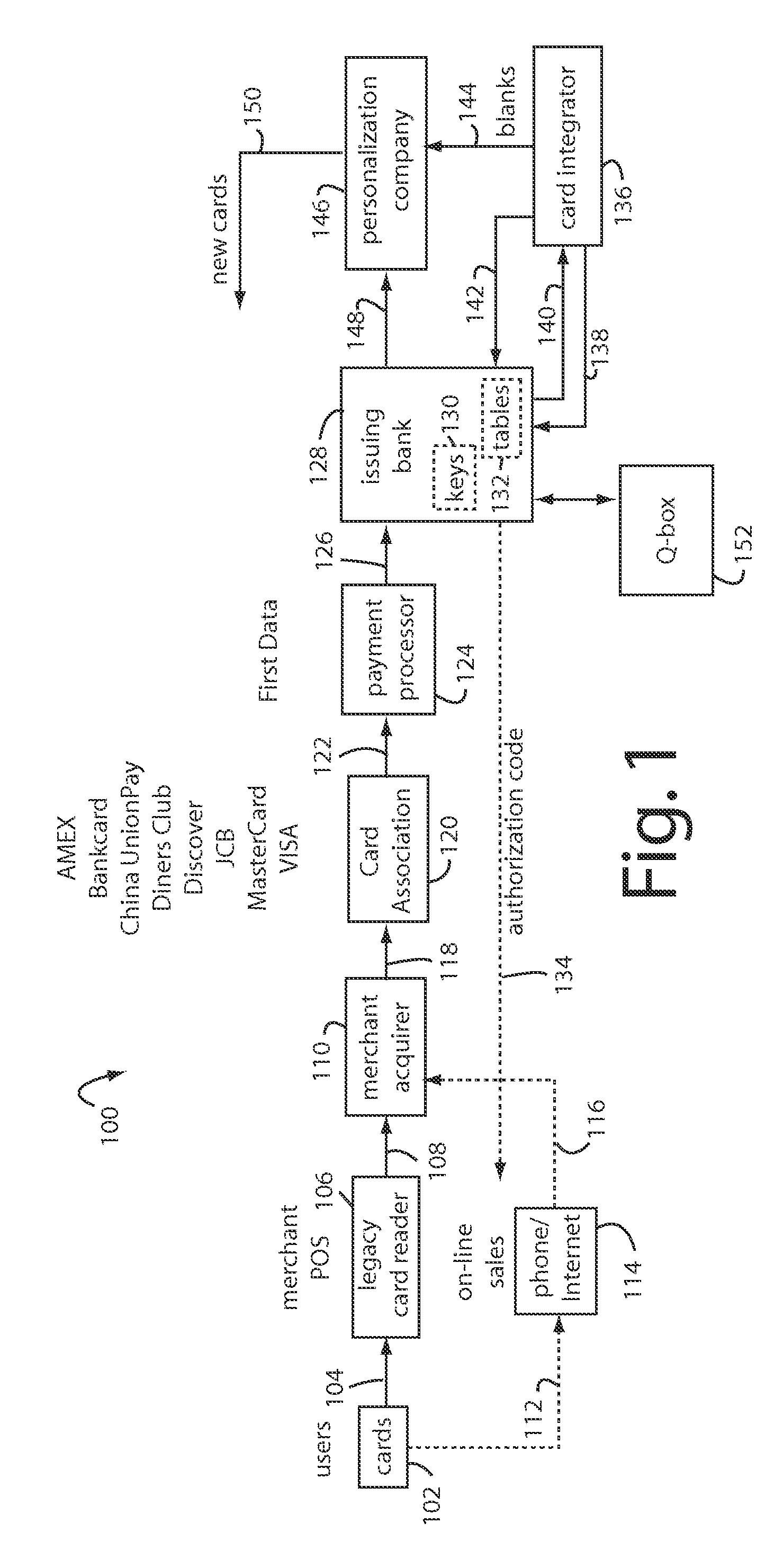

Financial transactions with dynamic personal account numbers

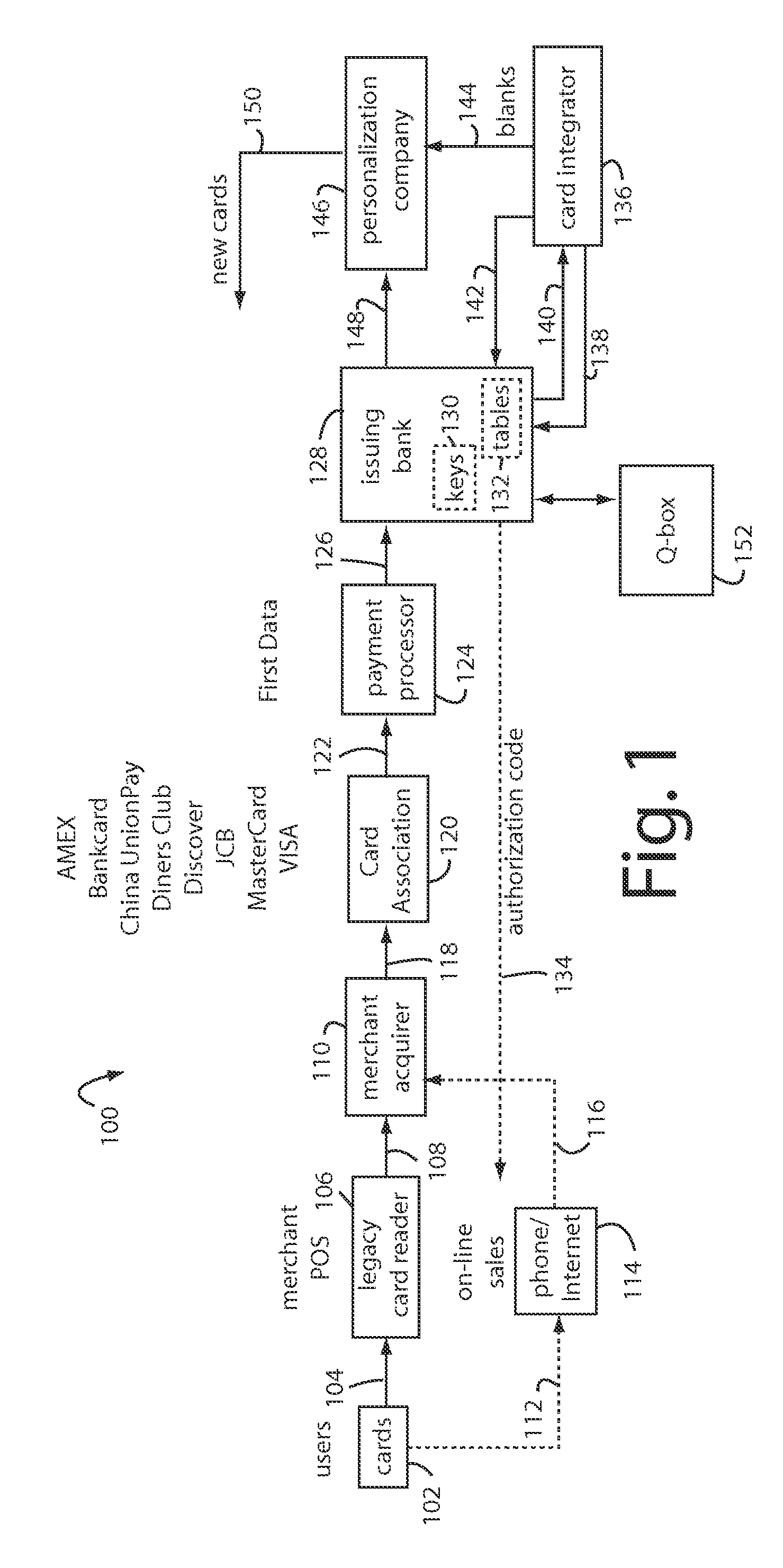

ActiveUS7580898B2Sufficient dataComputer security arrangementsPayment architecturePersonalizationIssuing bank

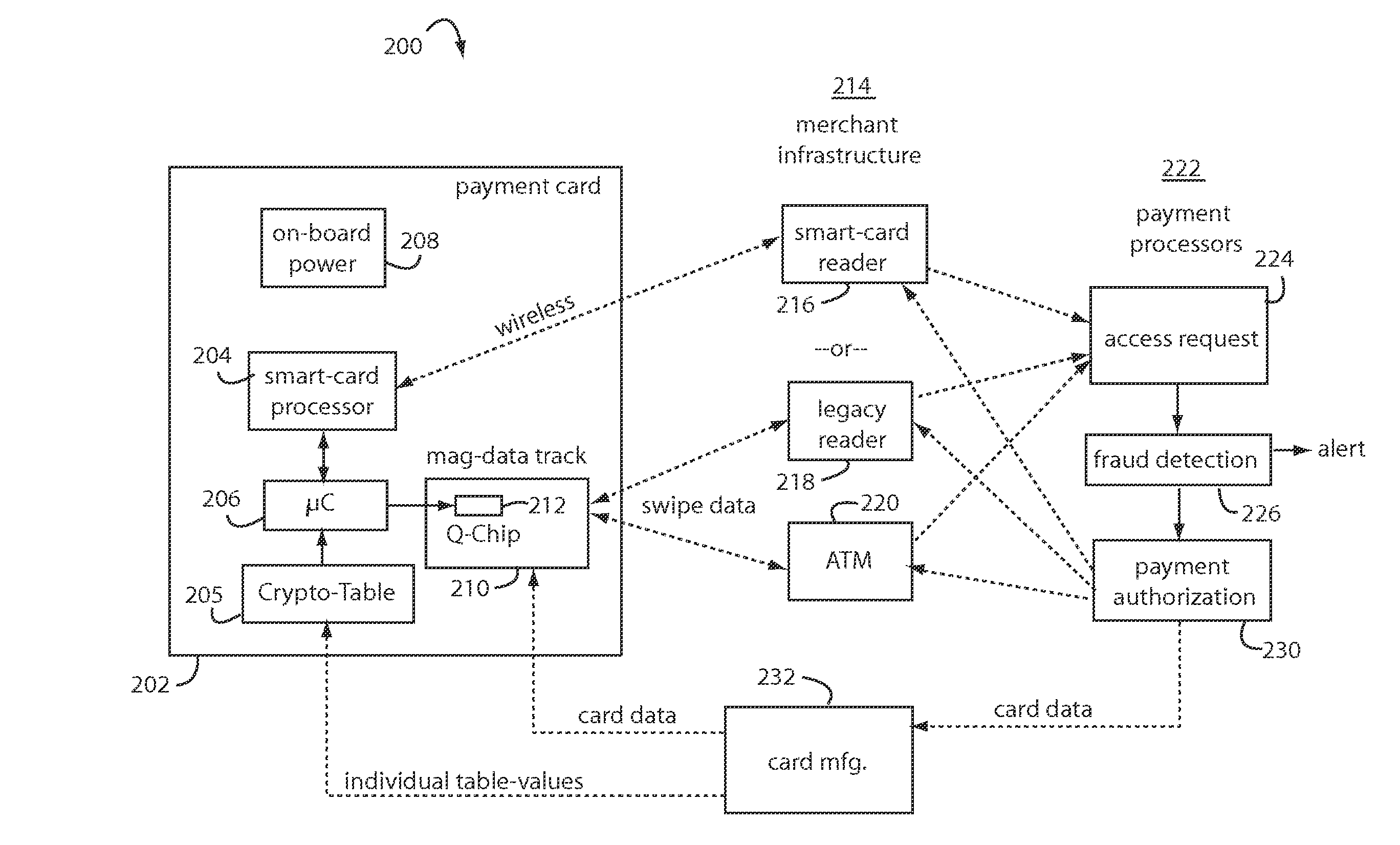

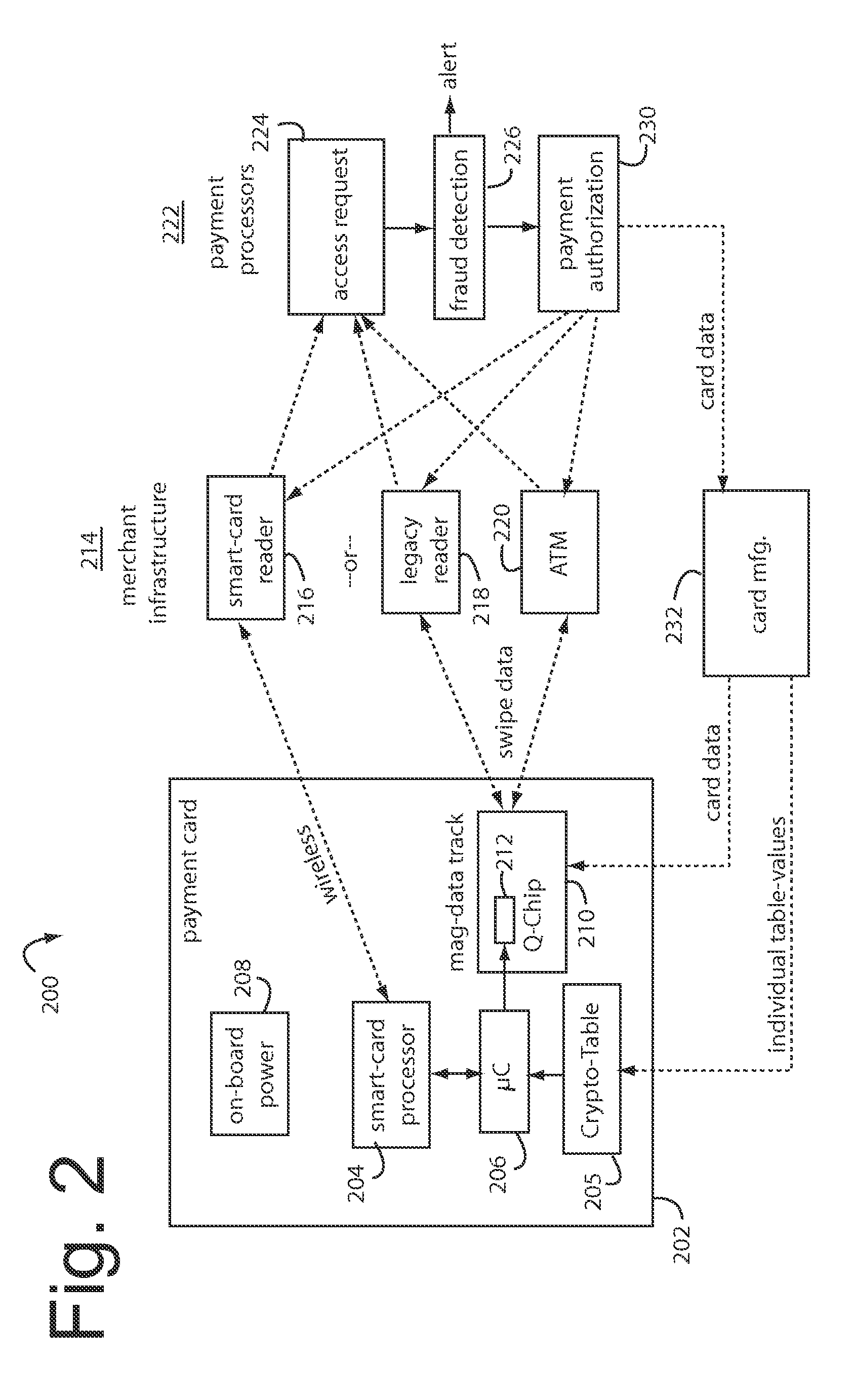

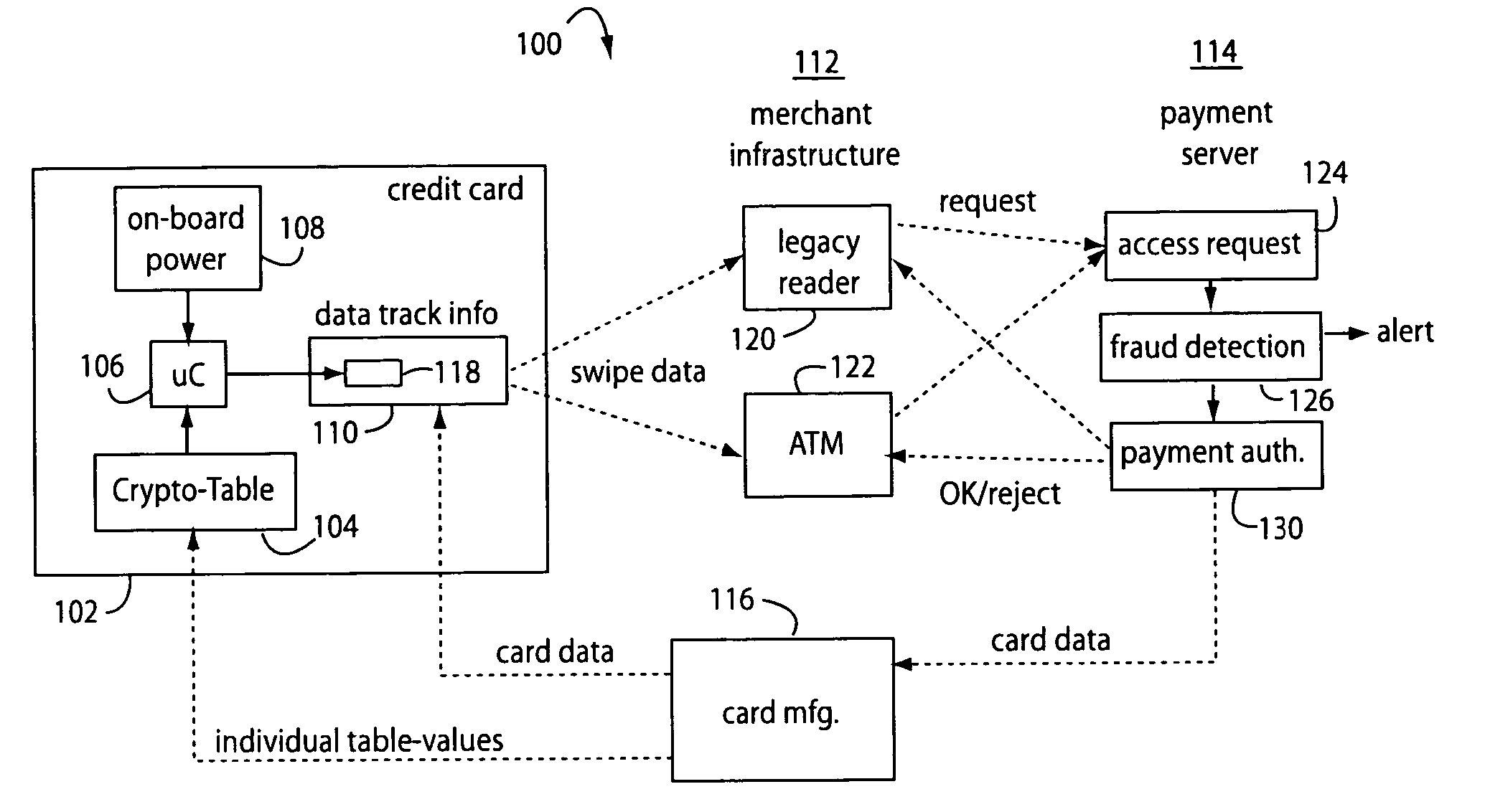

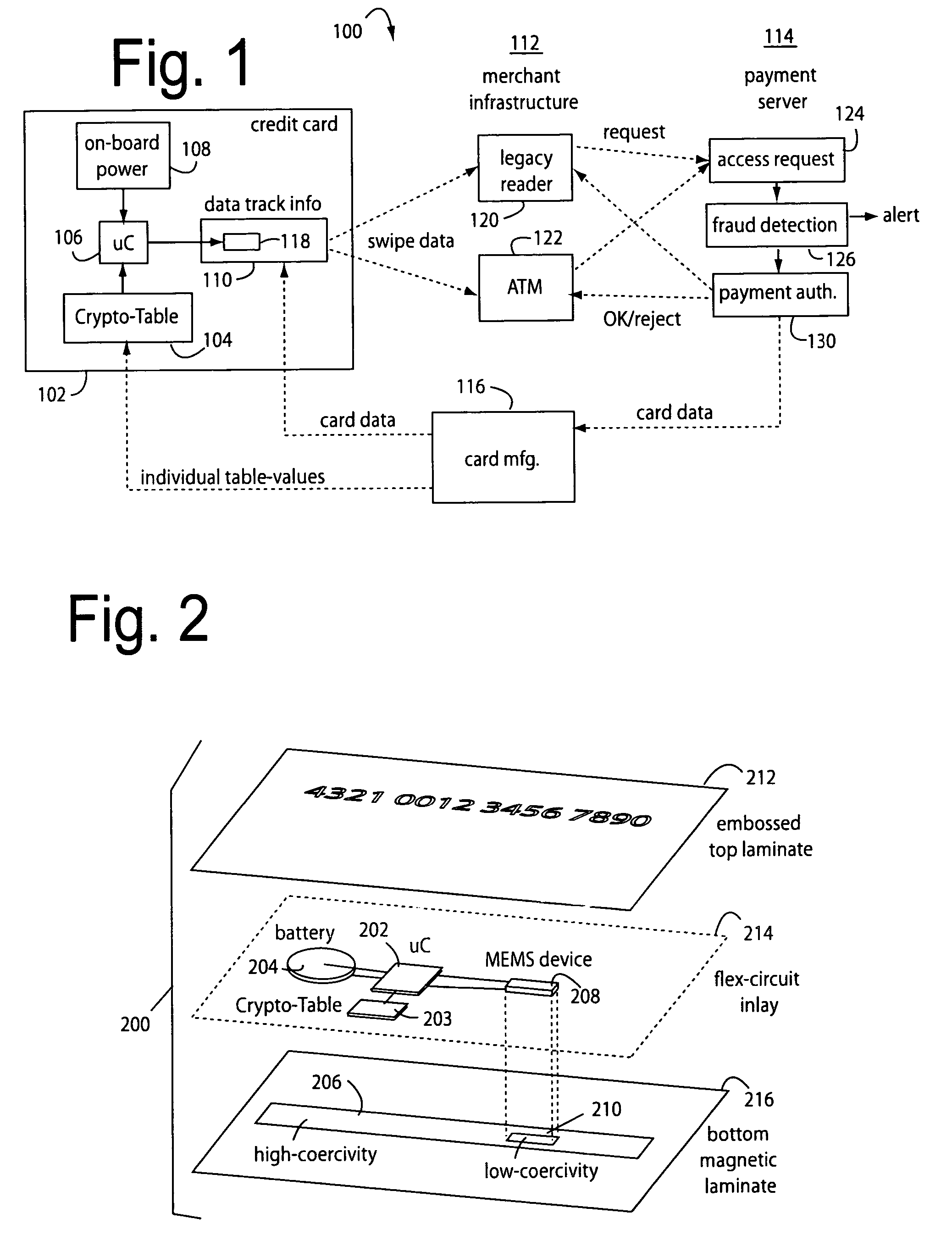

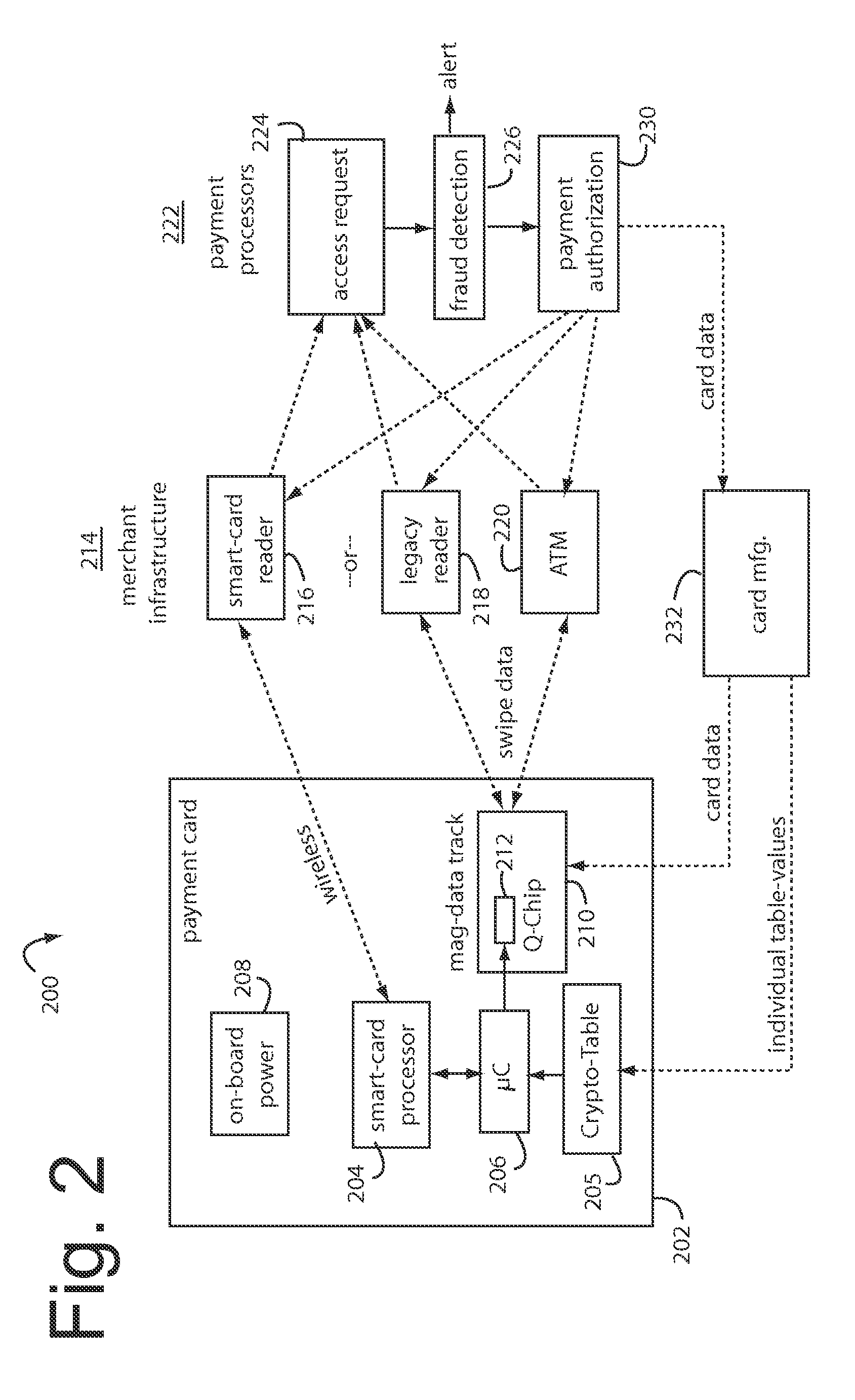

A method for securing financial transactions involving payment cards includes associating a sixteen-digit personal account number (PAN) with a particular payment card and user, wherein are included fields for a system number, a bank / product number, a user account number, and a check digit. A four-digit expiration date (MMYY) associated with the PAN. A magnetic stripe on the payment card is encoded with the PAN for periodic reading by a magnetic card reader during a financial transaction. A table of cryptographic values associated with the PAN and the MMYY is stored on each user's payment card during personalization by an issuing bank. A next financial transaction being commenced with the payment card is sensed. A cryptographic value from the table of cryptographic values is selected for inclusion as a dynamic portion of the user account number with the PAN when a next financial transaction is sensed. Any cryptographic value from the table of cryptographic values will not be used again in another financial transaction after being used once. The issuing bank authorizes the next financial transaction only if the PAN includes a correct cryptographic value in the user account number field.

Owner:FITBIT INC

Automated payment card fraud detection and location

A payment card fraud detection business model comprises an internal virtual account number generator and a user display for Card-Not-Present transactions. Card-Present transactions with merchant card readers are enabled by a magnetic array internally associated with the card's magnetic stripe. The internal virtual account number generator is able to reprogram some of the magnetic bits encoded in the magnetic stripe to reflect the latest virtual account number. The internal virtual account number generator produces a sequence of virtual numbers that can be predicted and approved by the issuing bank. Once a number is used, such is discarded and put on an exclusion list or reserved for a specific merchant until the expiration date. A server for the issuing bank logs the merchant locations associated with each use or attempted use, and provides real-time detection of fraudulent attempts to use a virtual account number on the exclusion list. Law enforcement efforts can then be directed in a timely and useful way not only where the fraud occurs but also at its origination.

Owner:FITBIT INC

Financial transactions with dynamic personal account numbers

ActiveUS20070208671A1Sufficient dataComputer security arrangementsPayment architecturePersonalizationIssuing bank

A method for securing financial transactions involving payment cards includes associating a sixteen-digit personal account number (PAN) with a particular payment card and user, wherein are included fields for a system number, a bank / product number, a user account number, and a check digit. A four-digit expiration date (MMYY) associated with the PAN. A magnetic stripe on the payment card is encoded with the PAN for periodic reading by a magnetic card reader during a financial transaction. A table of cryptographic values associated with the PAN and the MMYY is stored on each user's payment card during personalization by an issuing bank. A next financial transaction being commenced with the payment card is sensed. A cryptographic value from the table of cryptographic values is selected for inclusion as a dynamic portion of the user account number with the PAN when a next financial transaction is sensed. Any cryptographic value from the table of cryptographic values will not be used again in another financial transaction after being used once. The issuing bank authorizes the next financial transaction only if the PAN includes a correct cryptographic value in the user account number field.

Owner:FITBIT INC

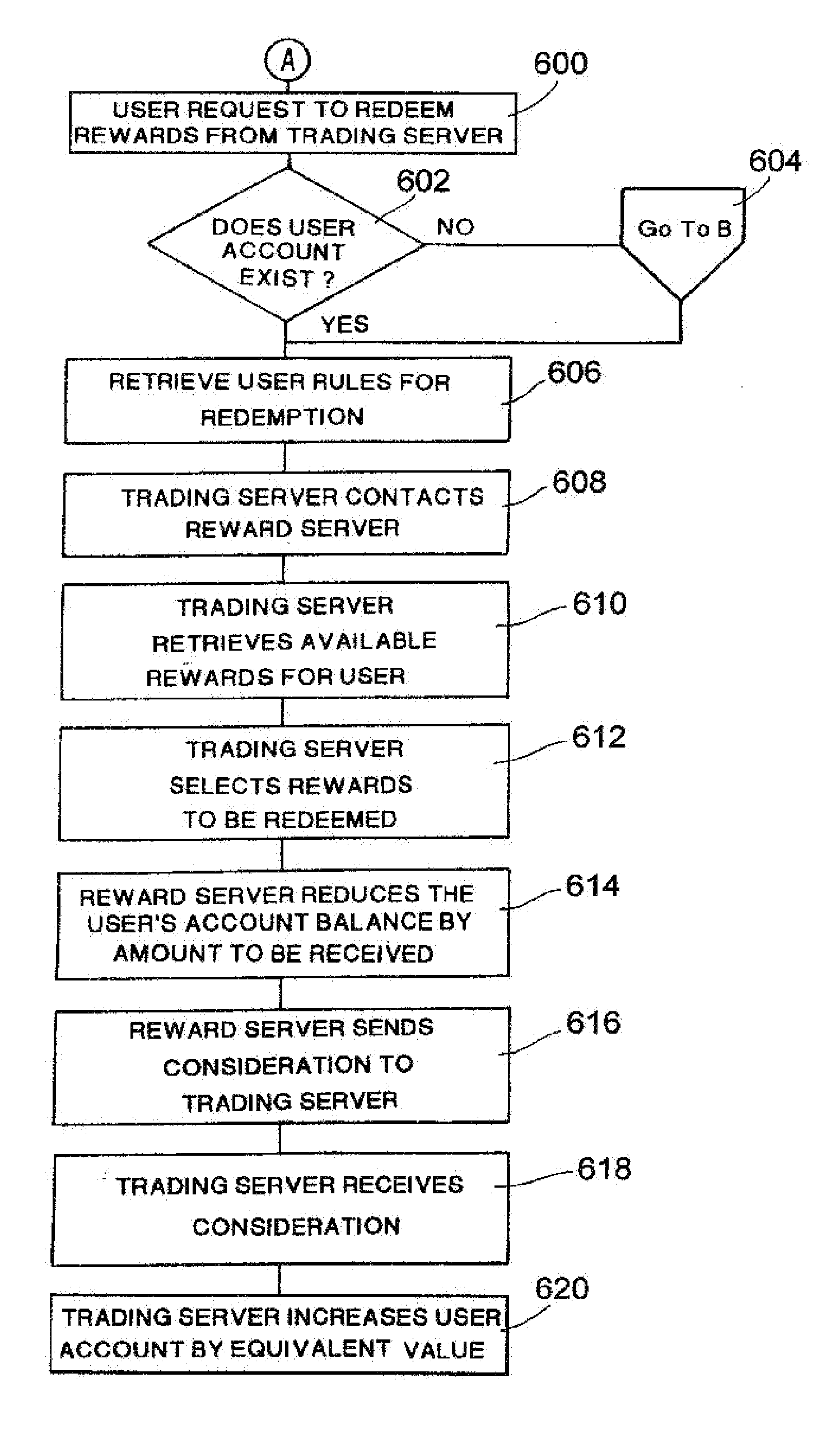

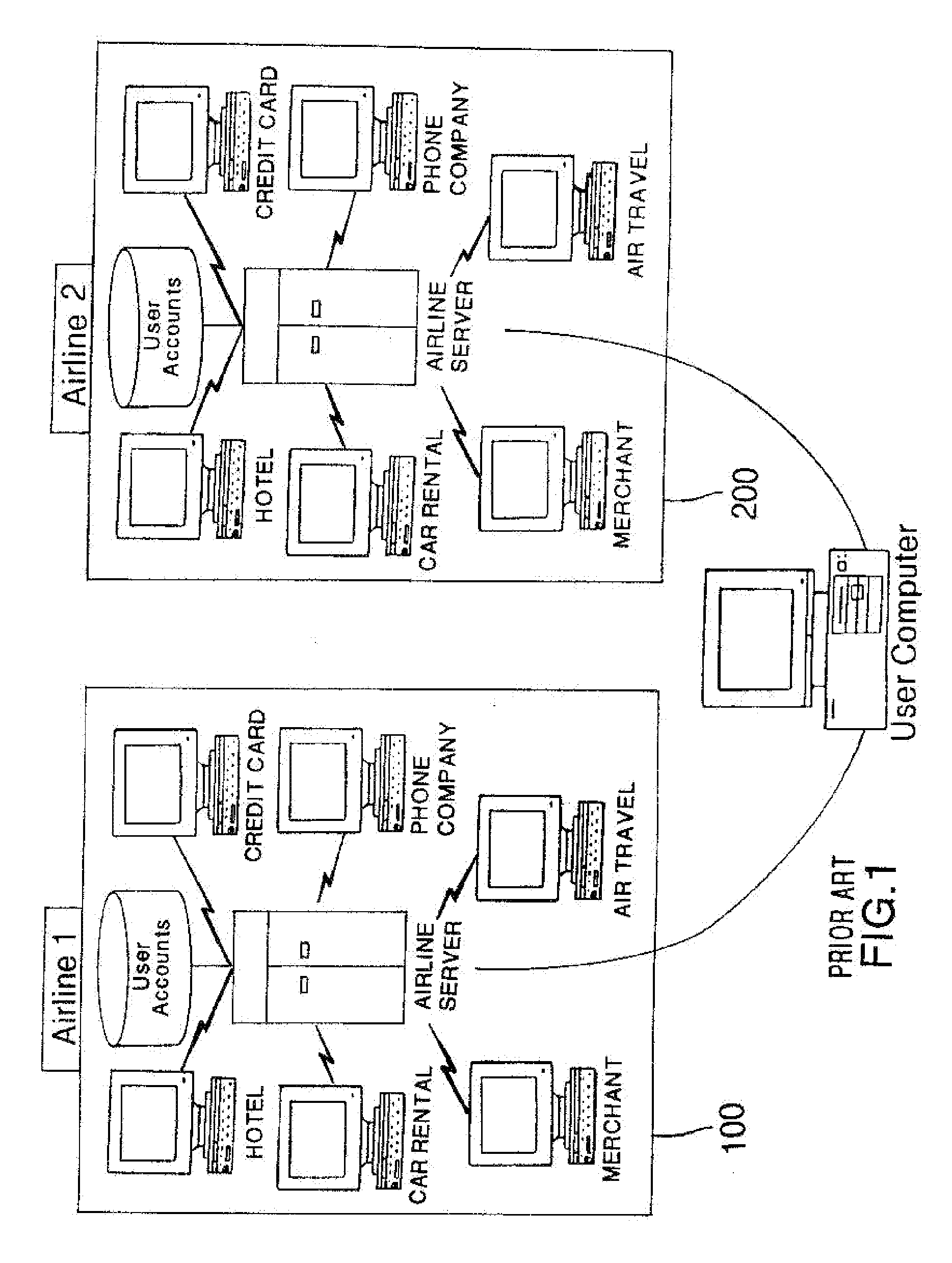

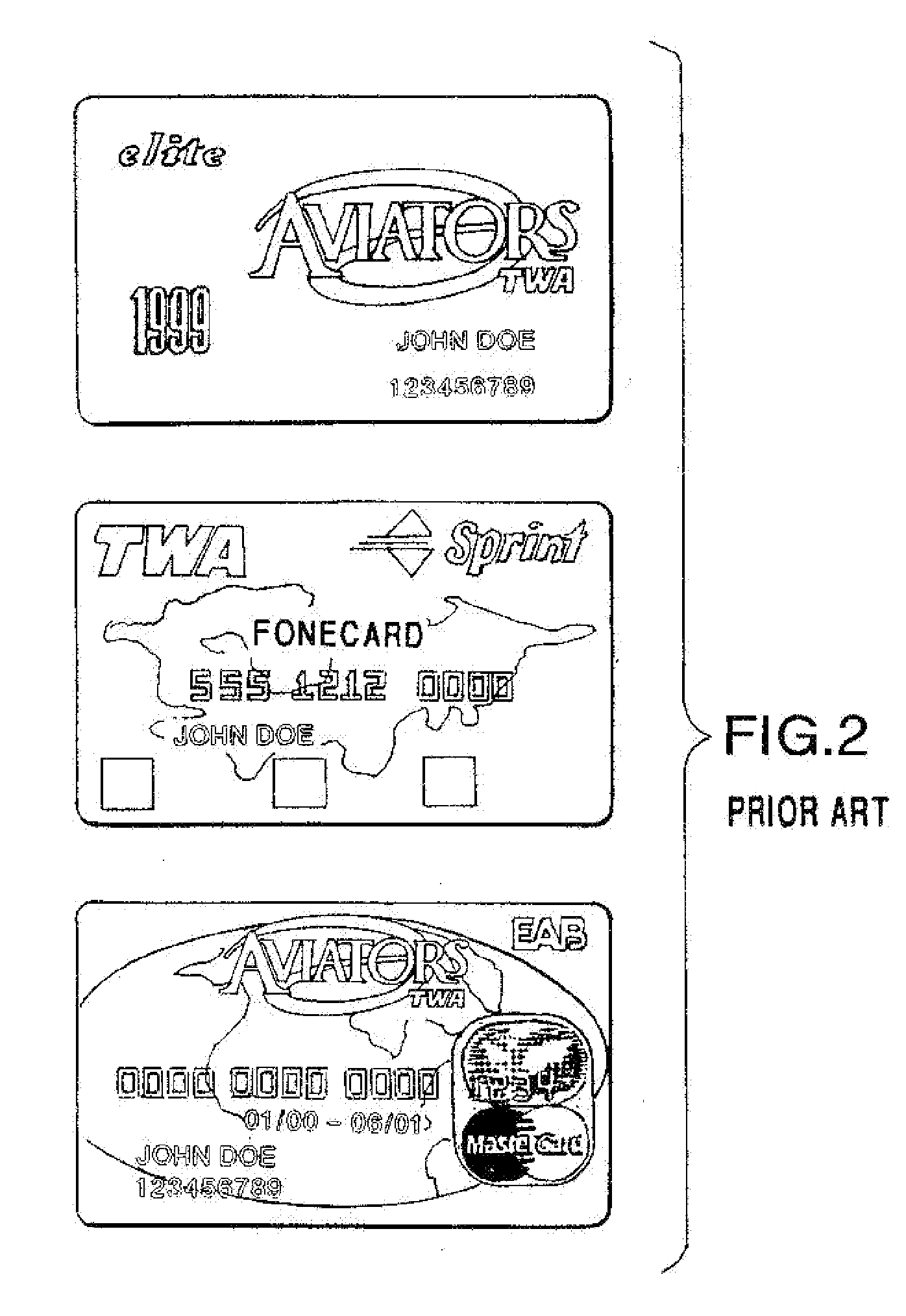

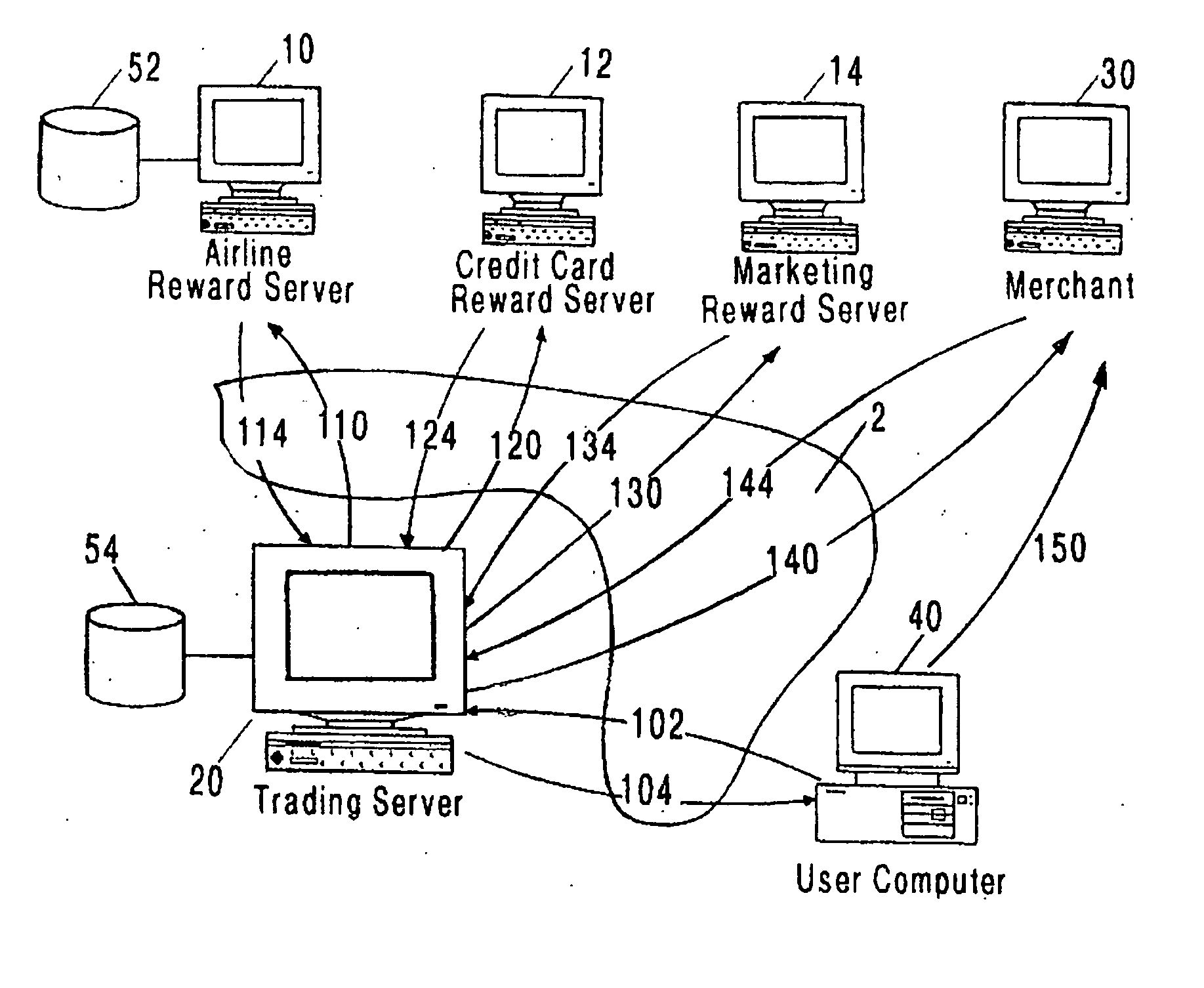

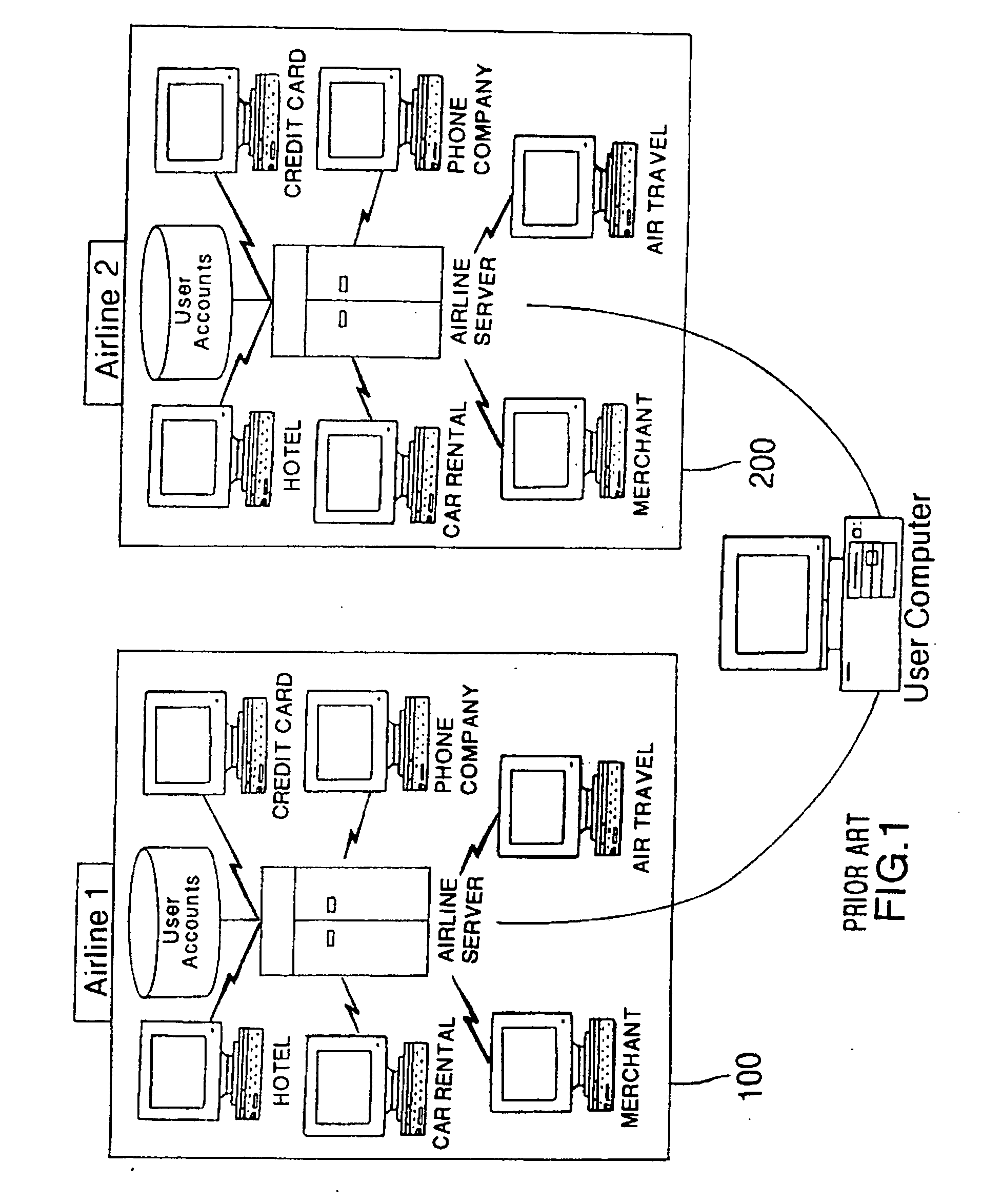

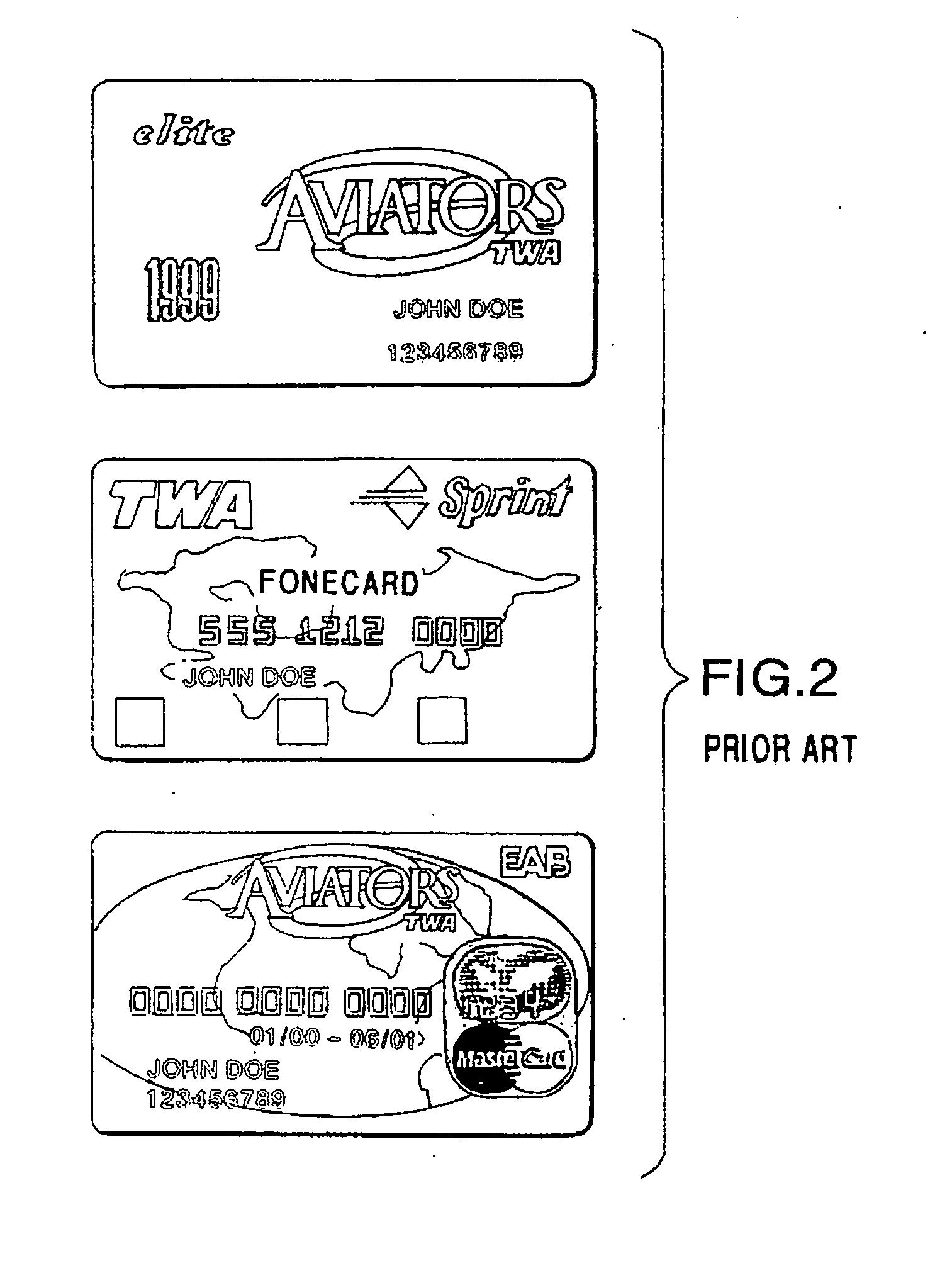

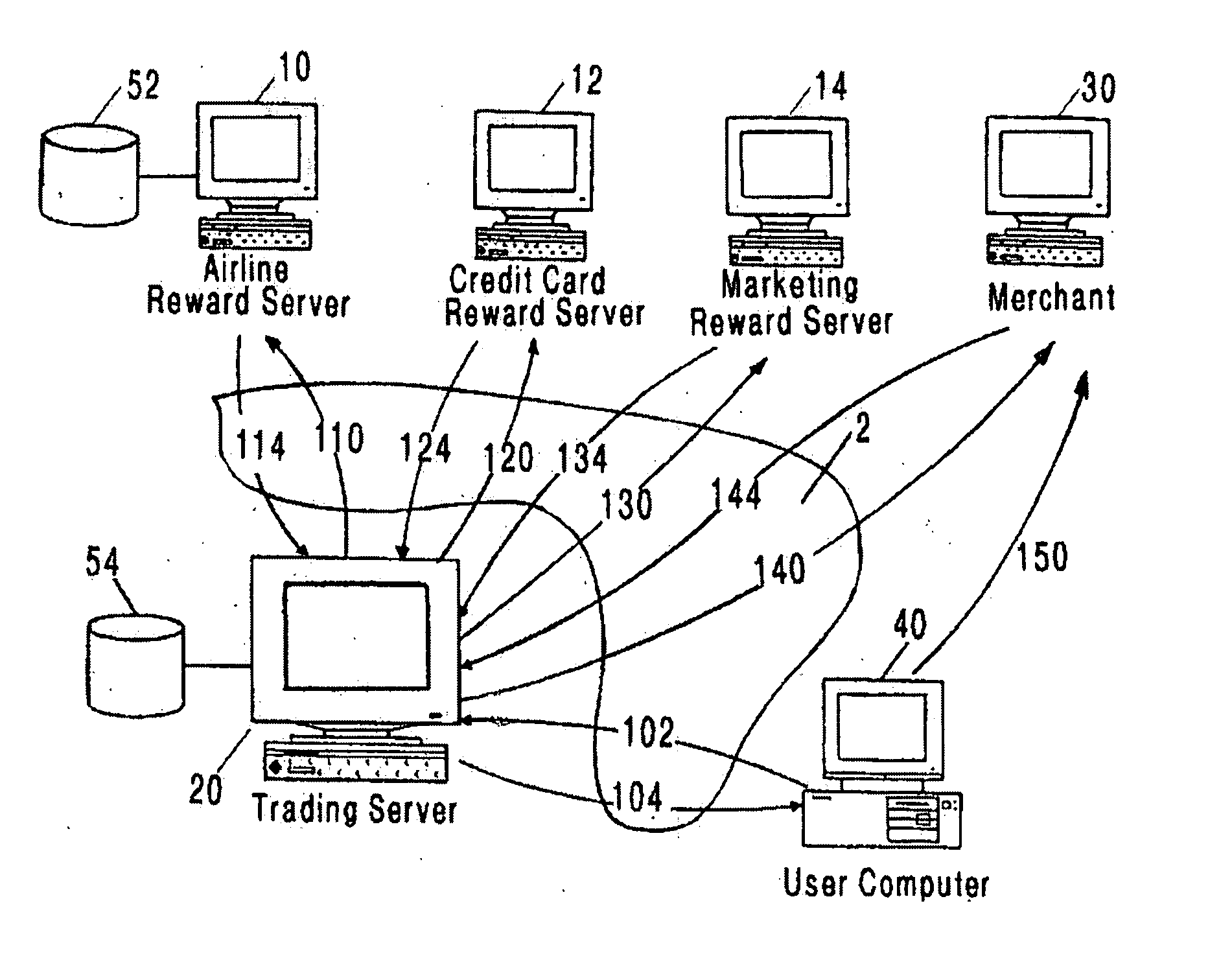

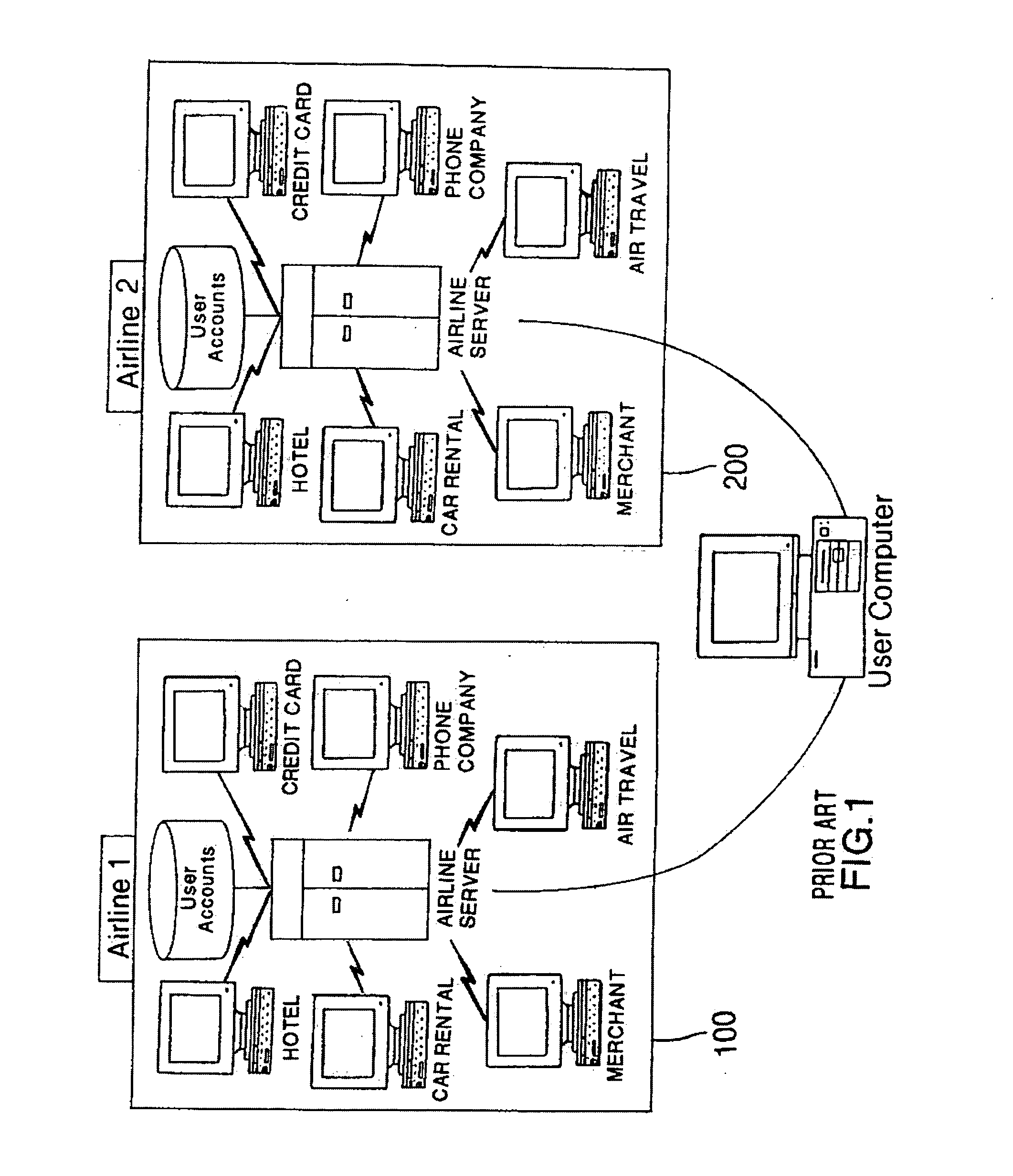

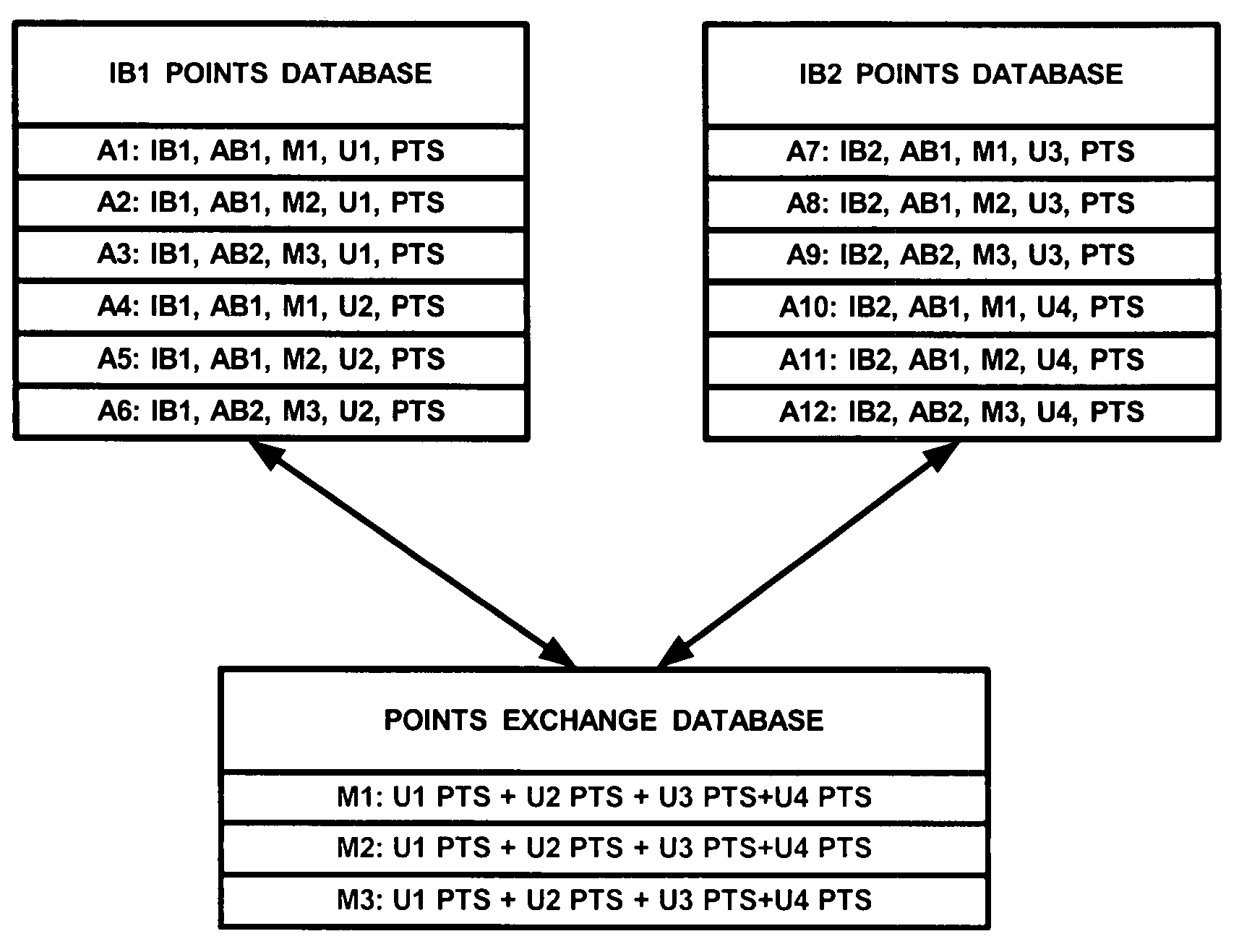

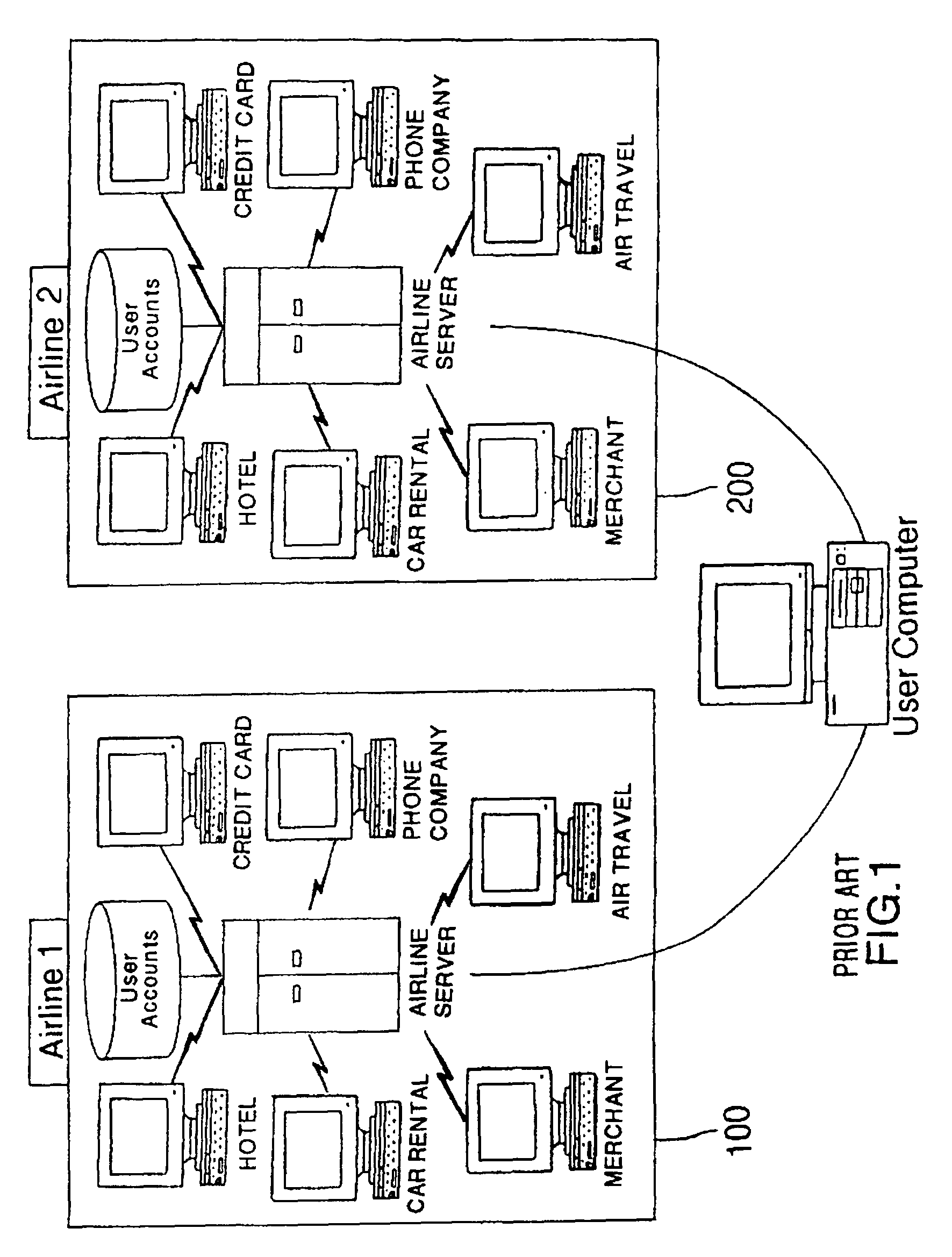

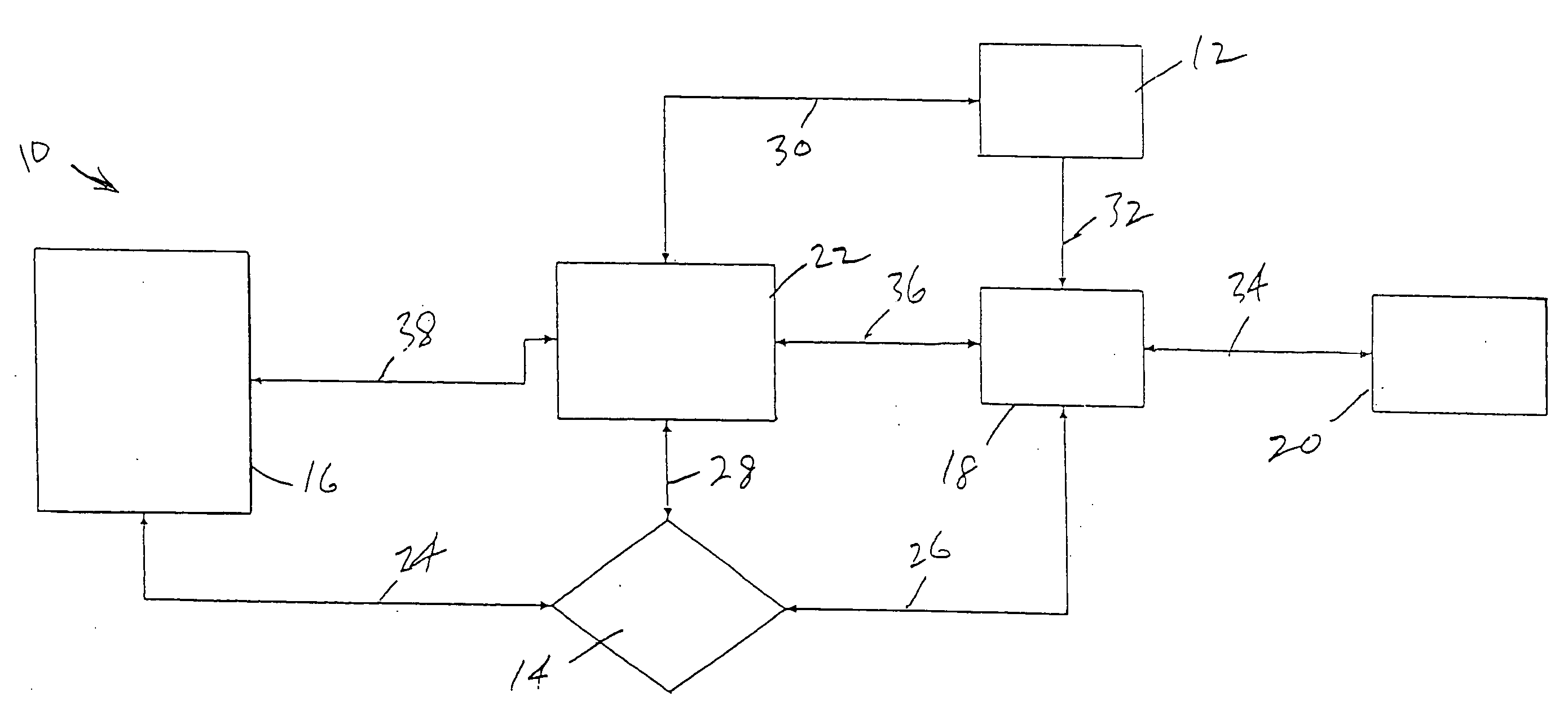

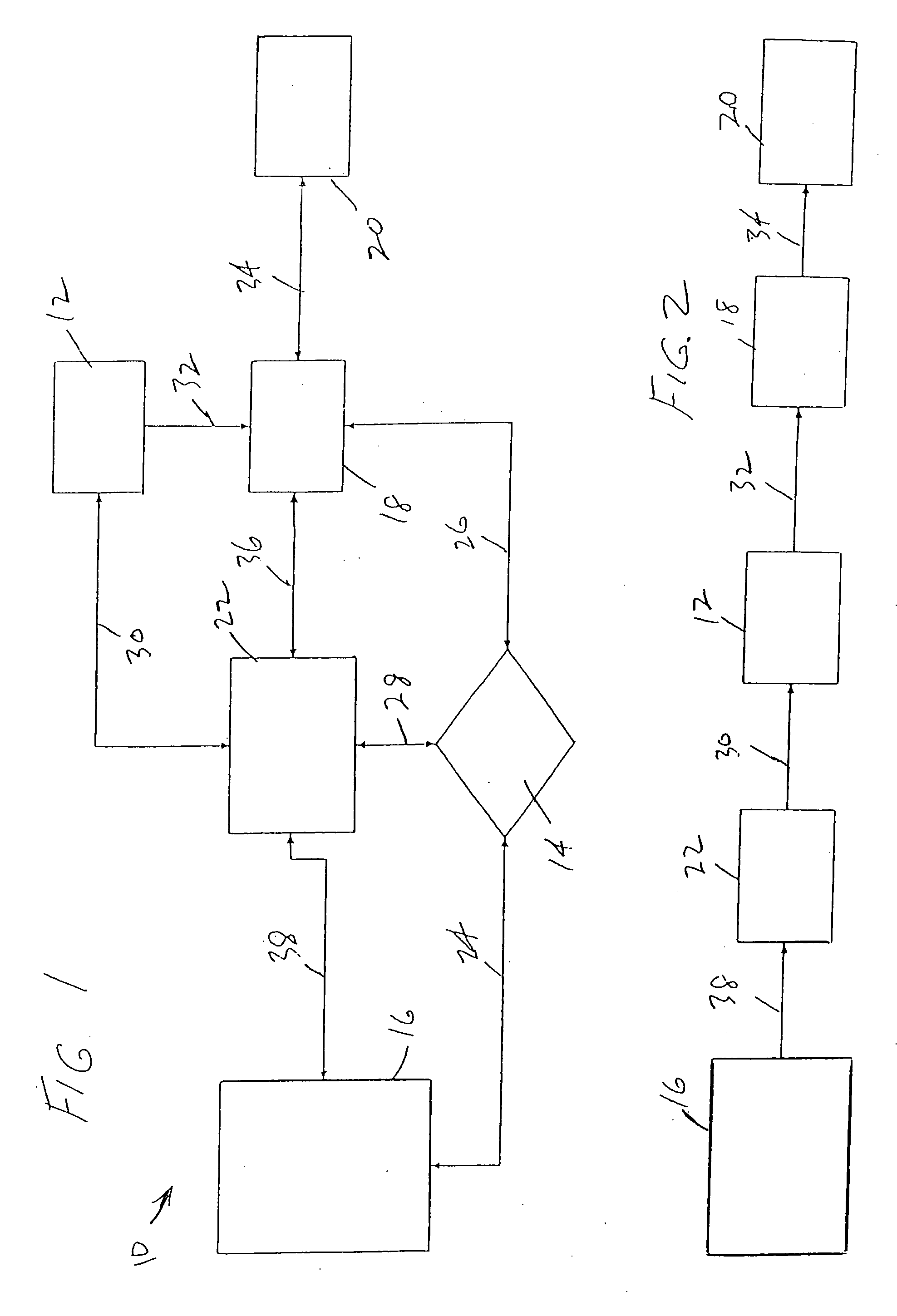

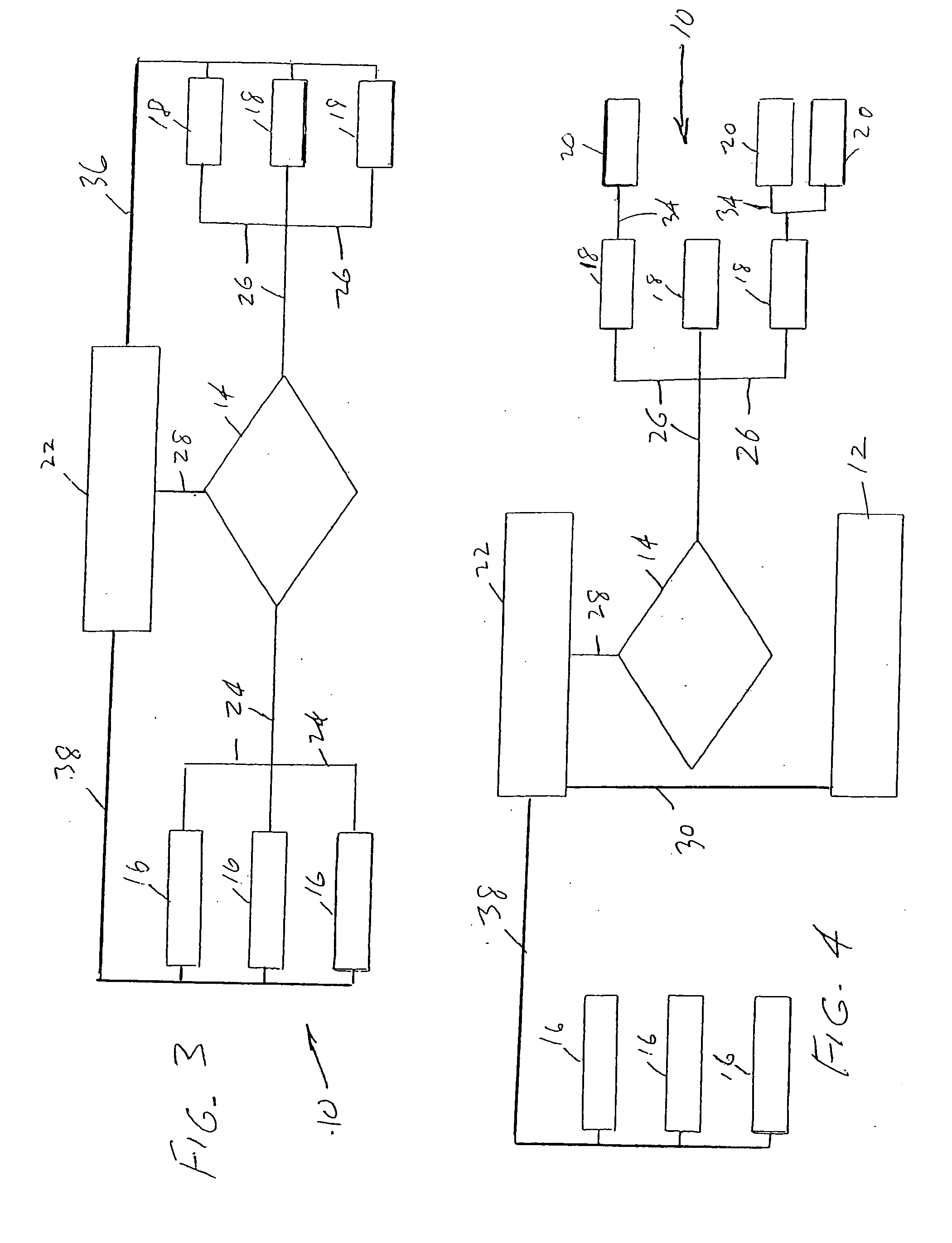

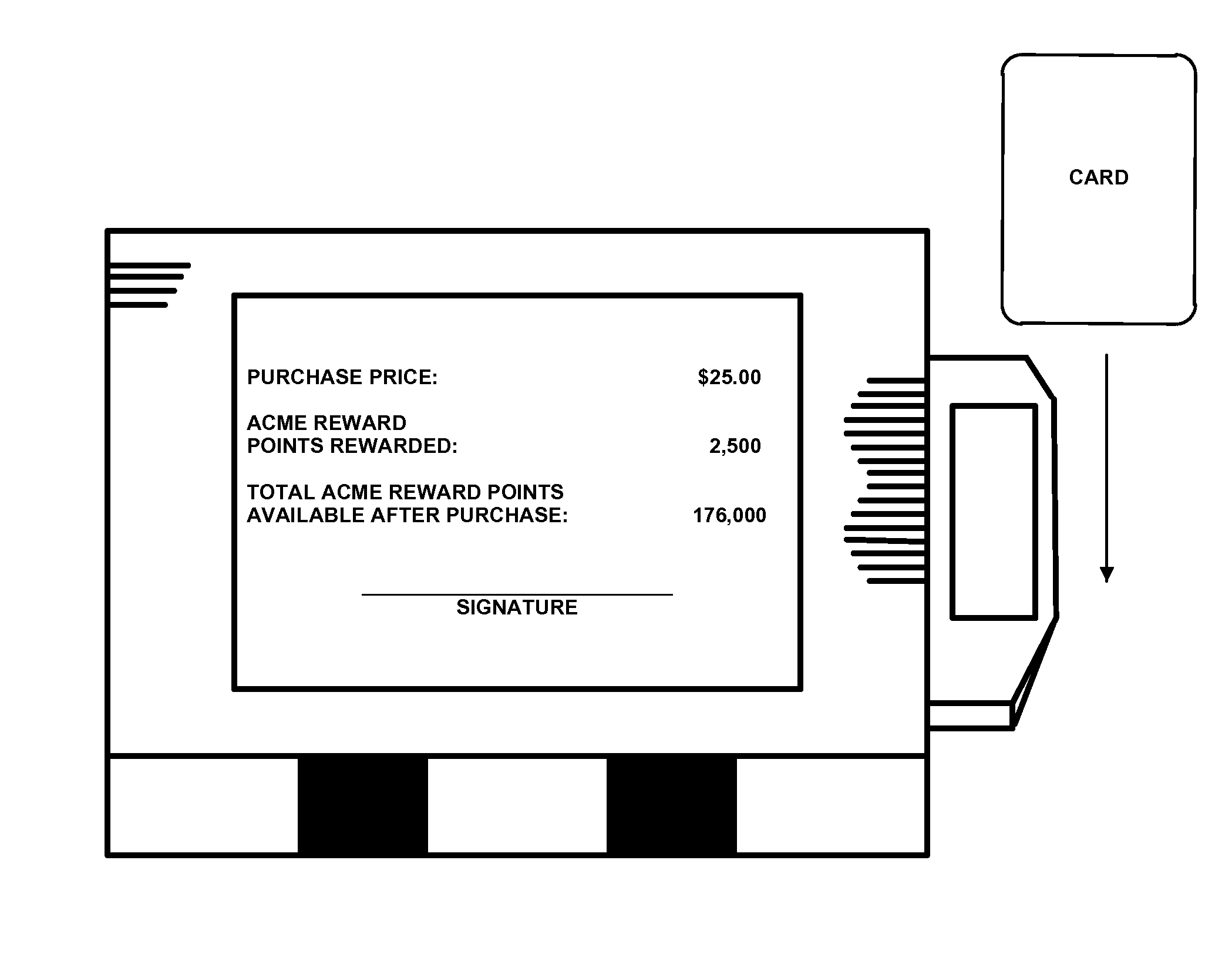

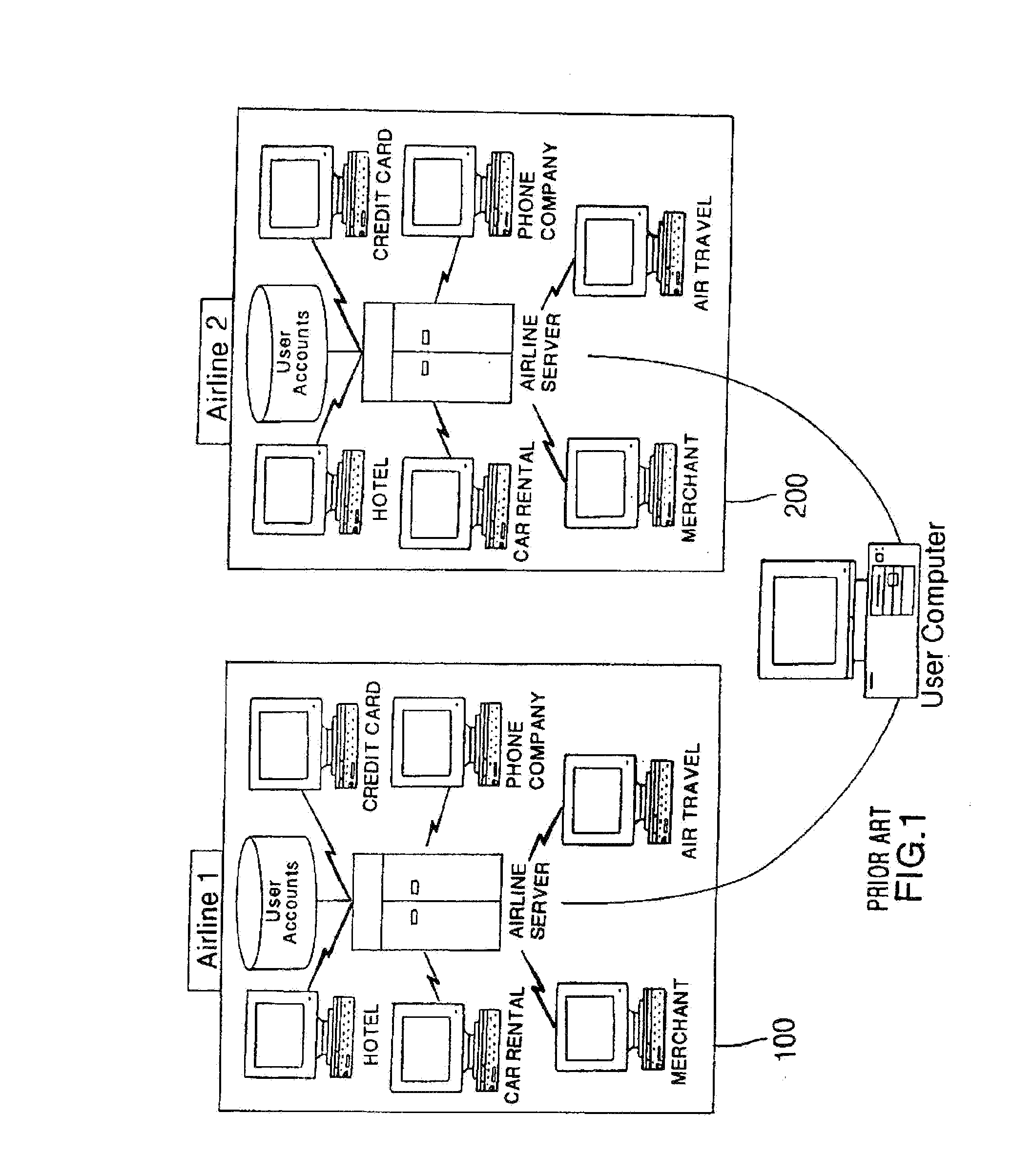

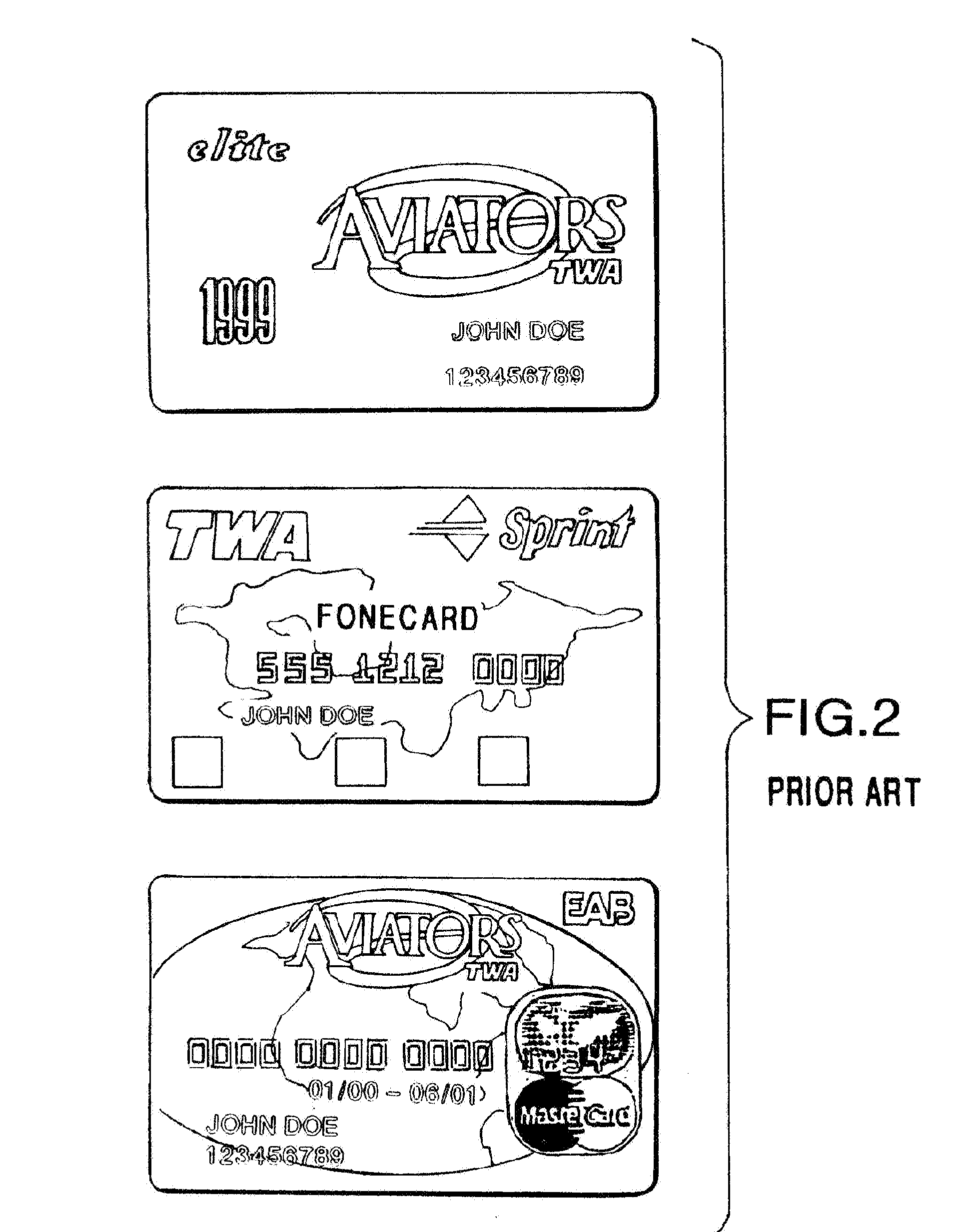

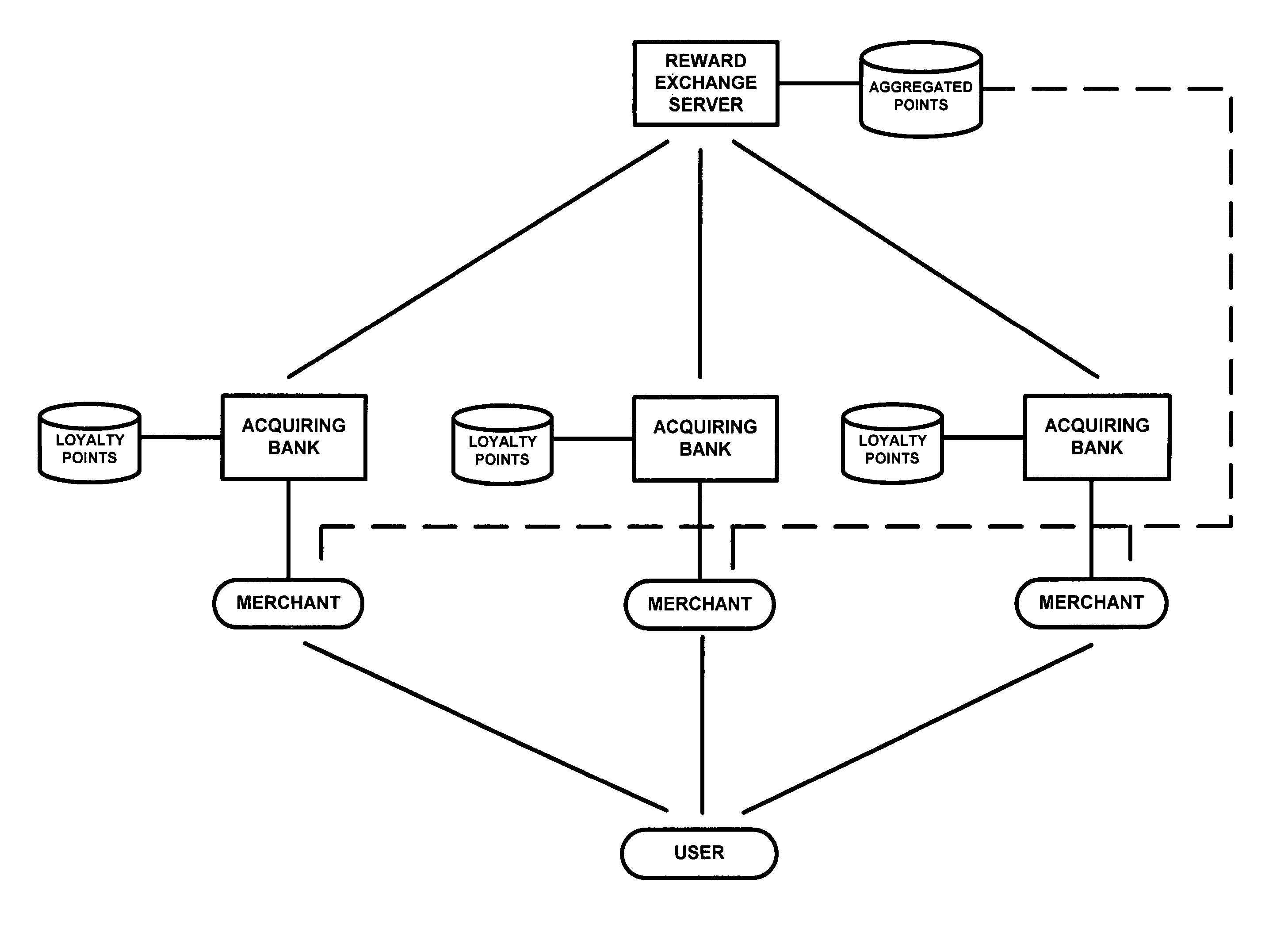

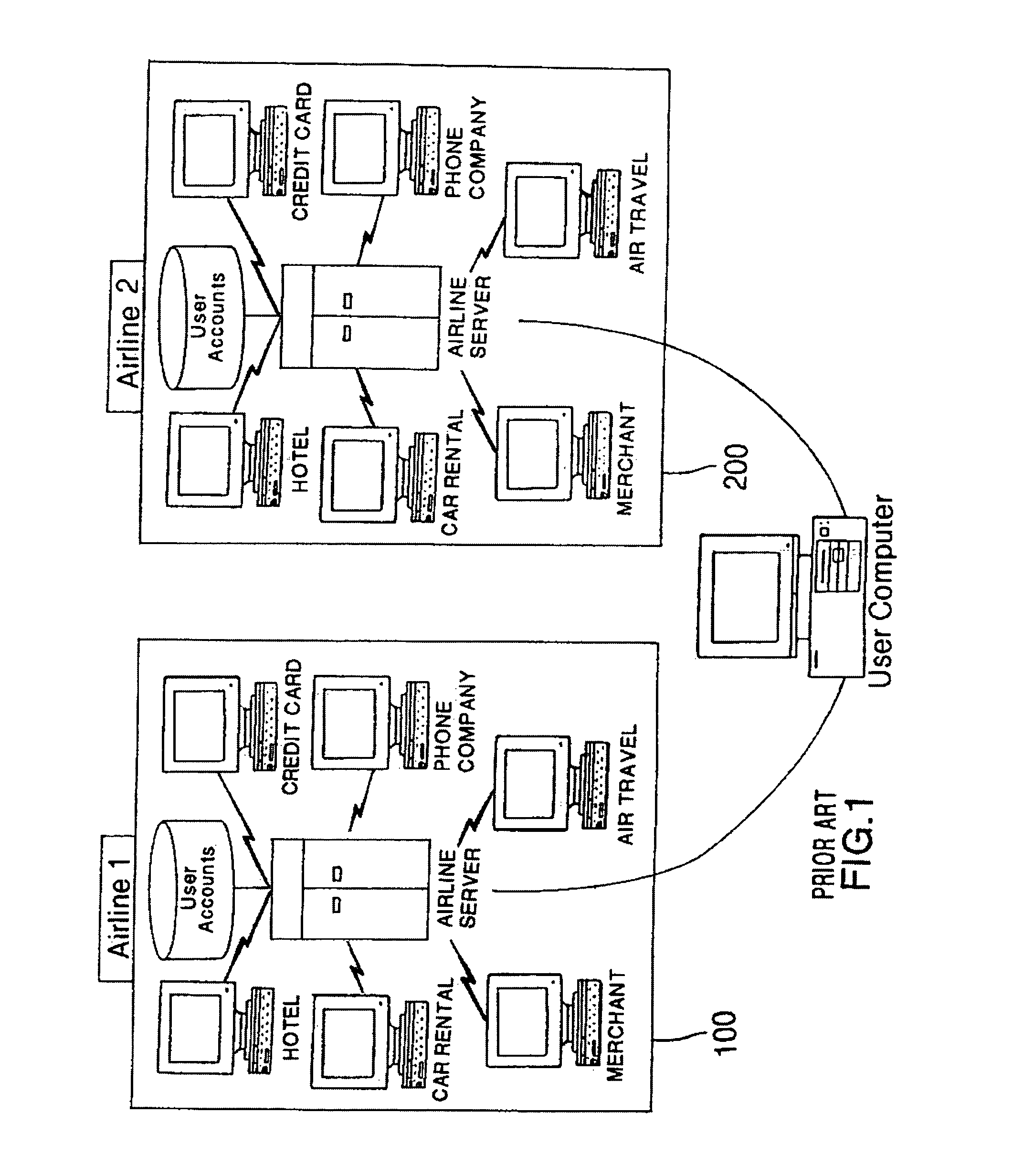

Method and system for issuing, aggregating and redeeming merchant reward points with a credit card network

A loyalty reward point system that utilizes the pre-existing infrastructure of network such as a credit card network. A user makes a purchase at a merchant using a token such as a credit card. As part of the purchase transaction, the user is awarded reward points from the merchant based on the purchase, which are stored in an account associated with the merchant and the user by a member bank of the credit card network, which may be an issuing bank or an acquiring bank. The reward account is maintained on the member bank server on behalf of the merchant and the user, and the number of reward points in the user's account for that merchant is increased accordingly. The user may redeem the reward points earned from the transaction with the merchant at a later time, or may redeem the points with another merchant in the same marketing cluster, or may aggregate those reward points with those of other merchants into a reward point exchange account, and then redeem the aggregated reward points for goods or services from any approved merchant on the network, depending on the configuration of the system.

Owner:SIGNATURE SYST

Method and system for issuing, aggregating and redeeming merchant loyalty points with an issuing bank

InactiveUS20050149394A1High cost of administrationHigh cost of setupSpecial data processing applicationsMarketingIssuing bankCredit card

A loyalty reward point system that utilizes the pre-existing infrastructure of network such as a credit card network. A user makes a purchase at a merchant using a token such as a credit card. As part of the purchase transaction, the user is awarded reward points from the merchant based on the purchase, which are stored in an account associated with the merchant and the user by the issuing bank. The reward account is maintained on the issuing bank server on behalf of the merchant and the user, and the number of reward points in the user's account for that merchant is increased accordingly. The user may redeem the reward points earned from the transaction with the merchant at a later time, or may redeem the points with another merchant in the same marketing cluster, or may aggregate those reward points with those of other merchants into a reward point exchange account, and then redeem the aggregated reward points for goods or services from any approved merchant on the network, depending on the configuration of the system.

Owner:SIGNATURE SYST

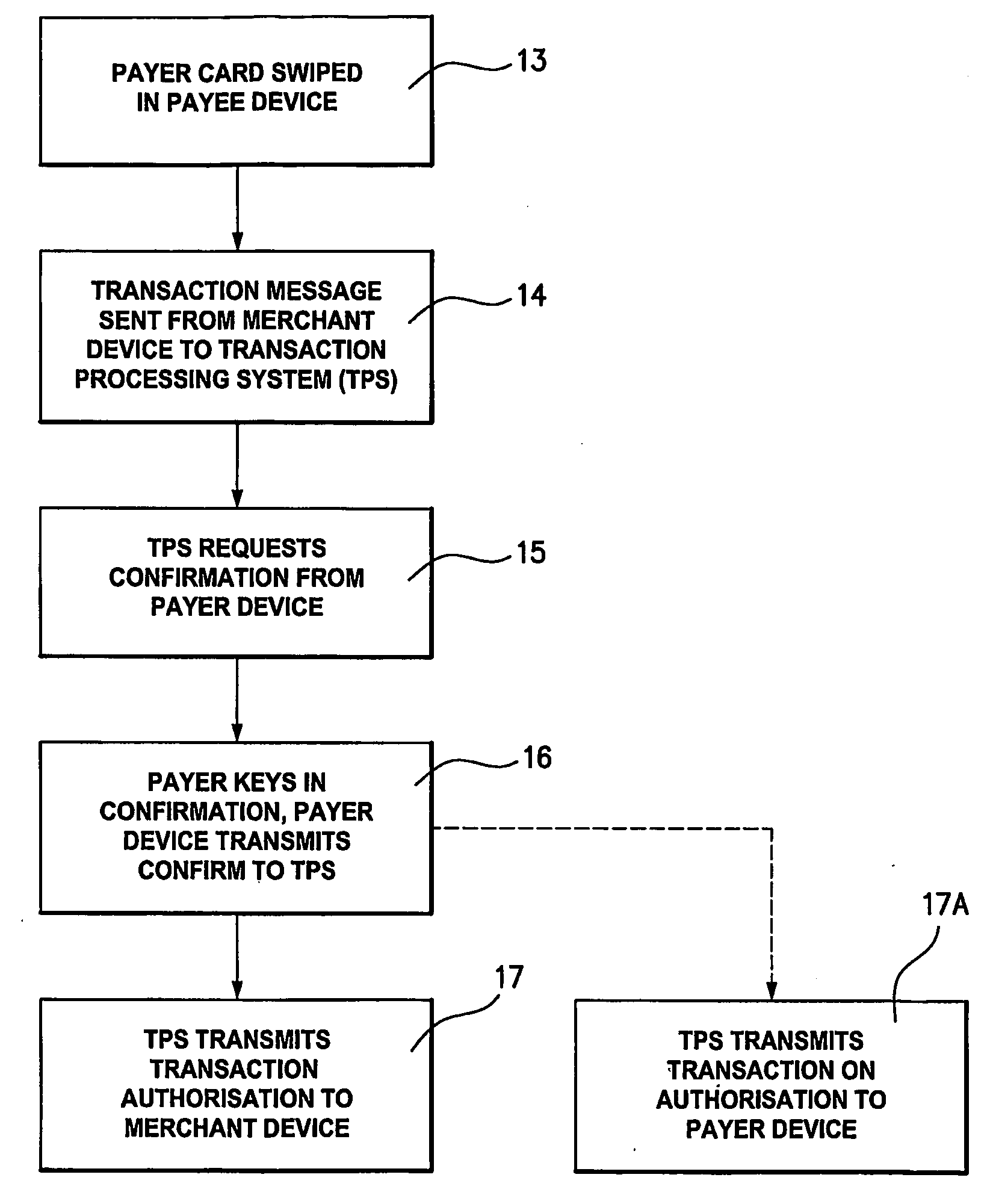

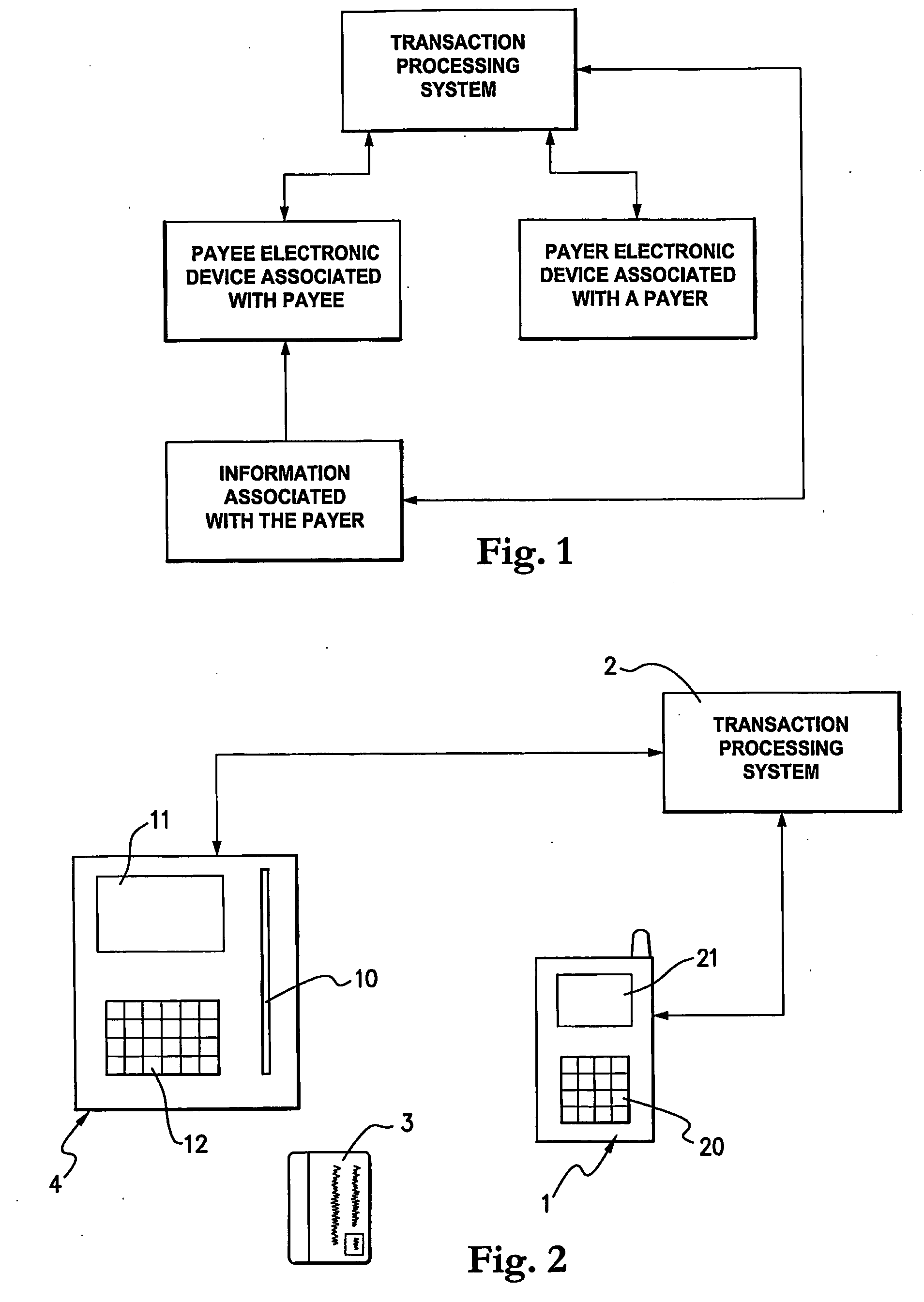

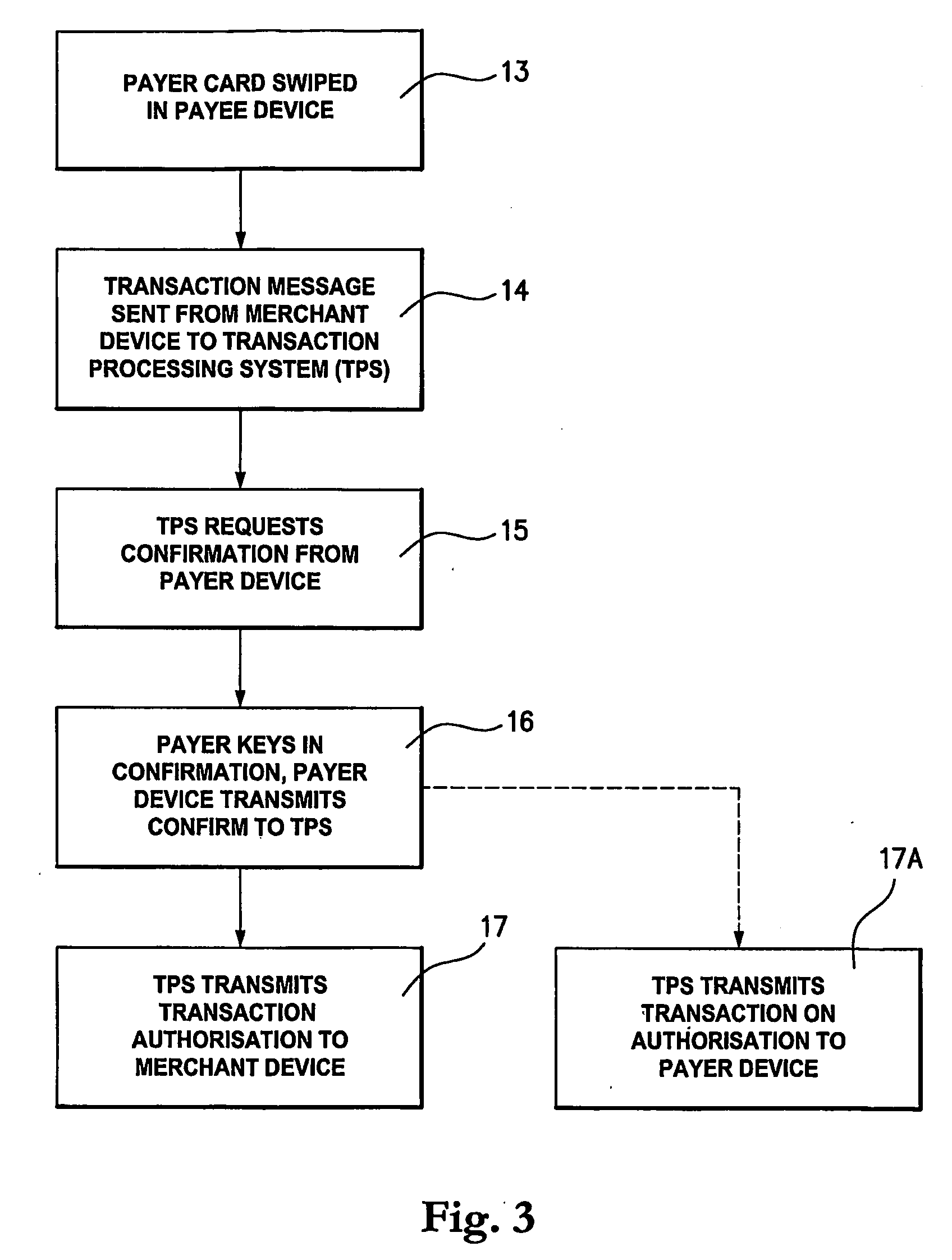

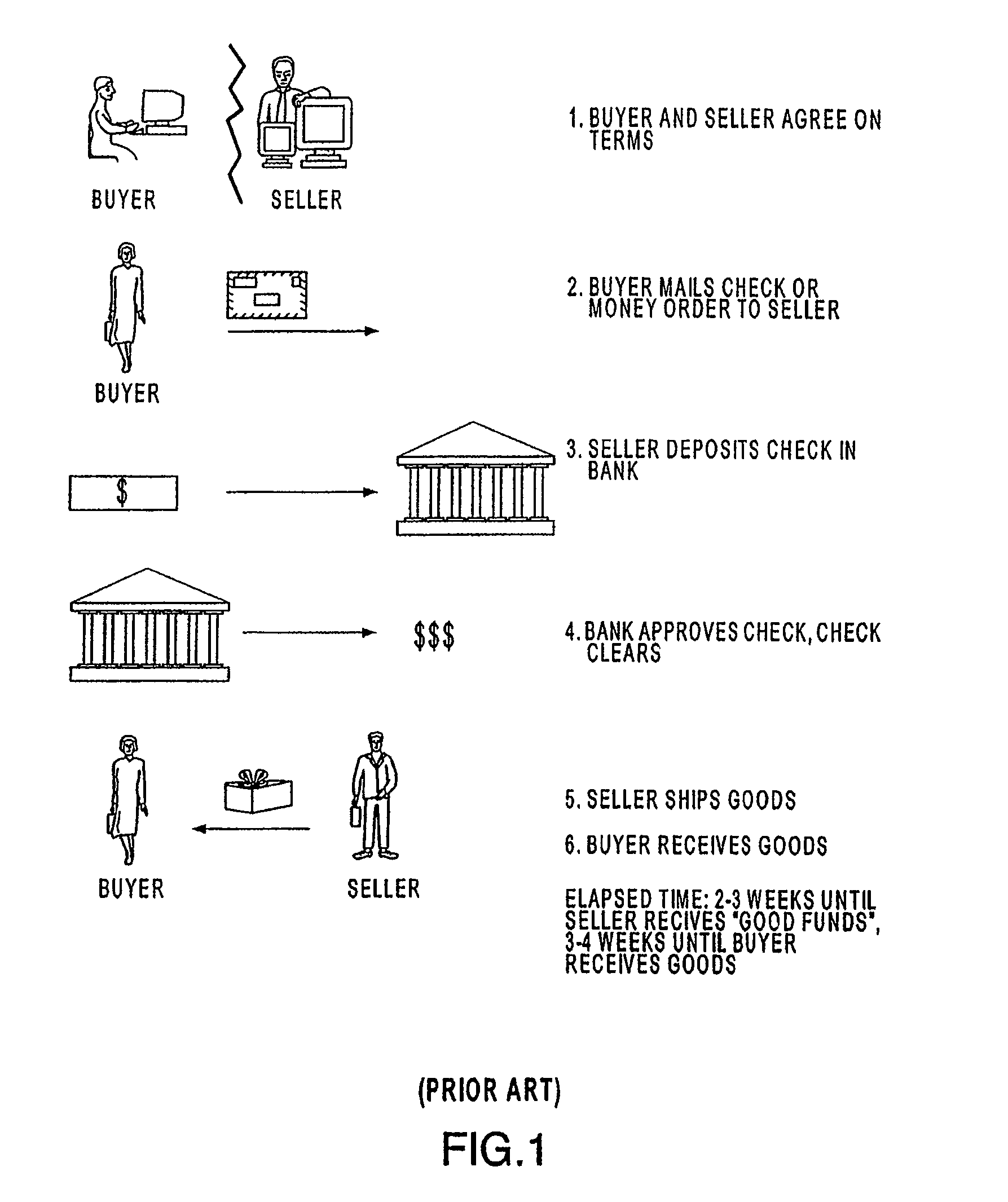

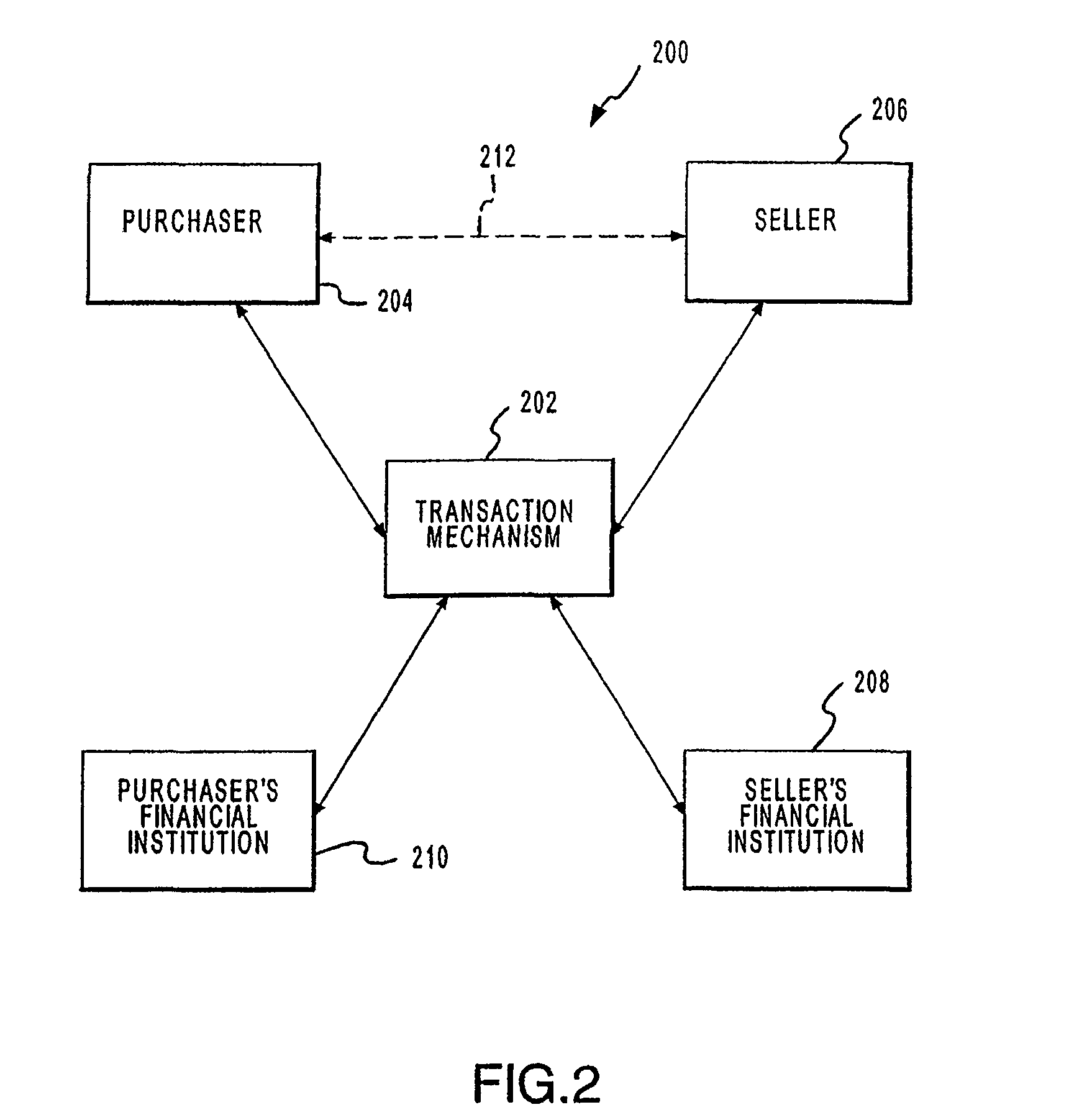

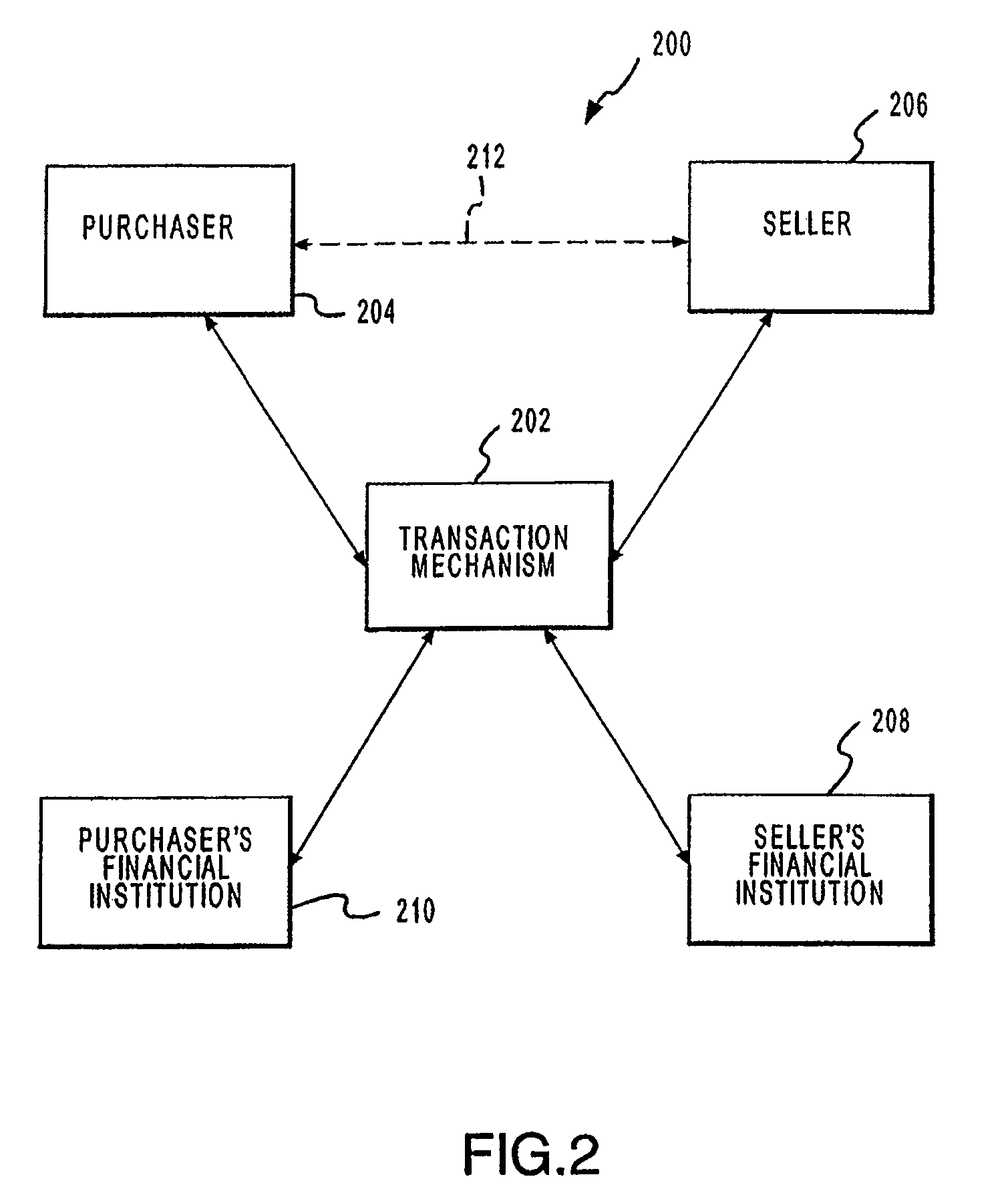

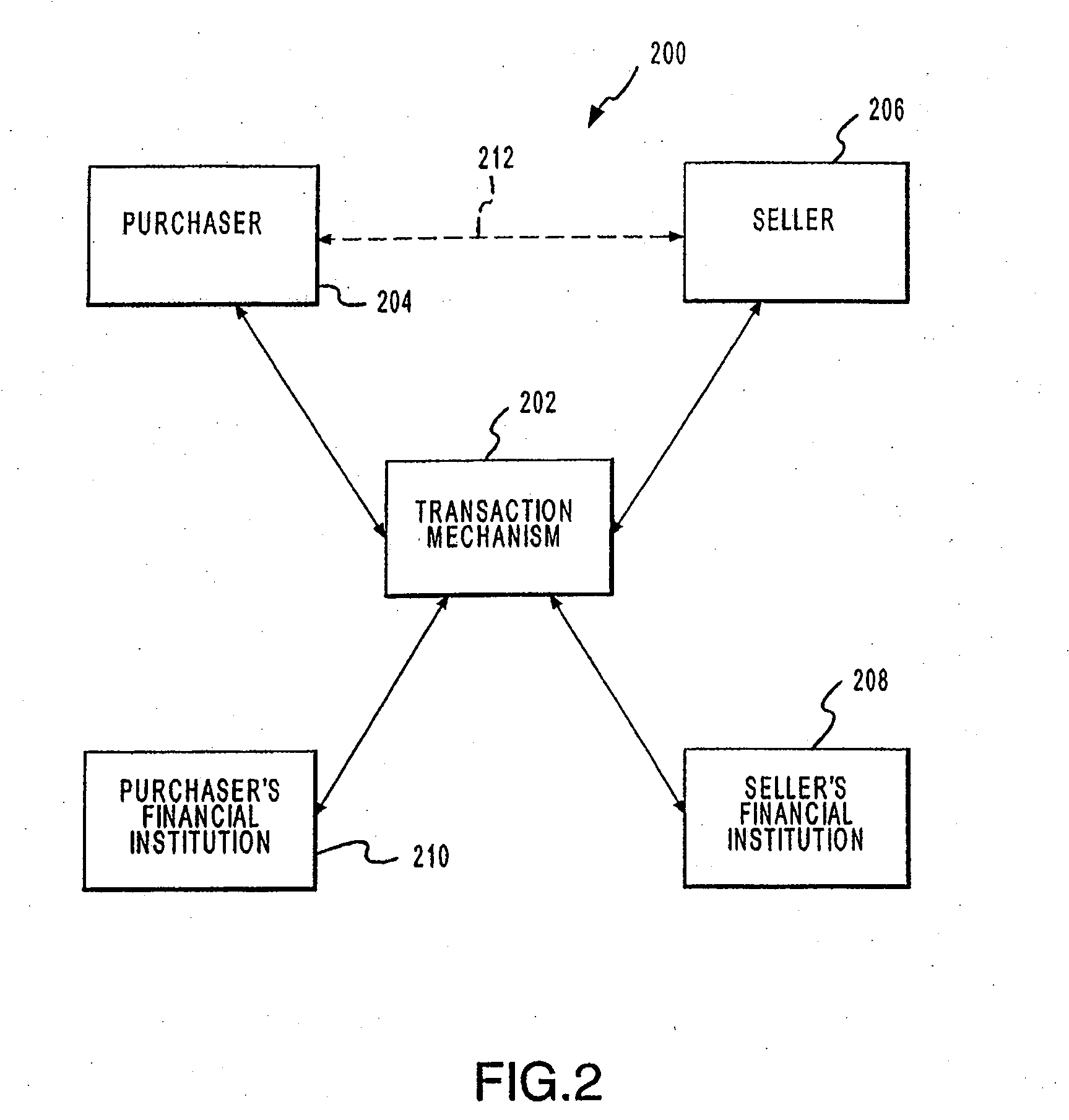

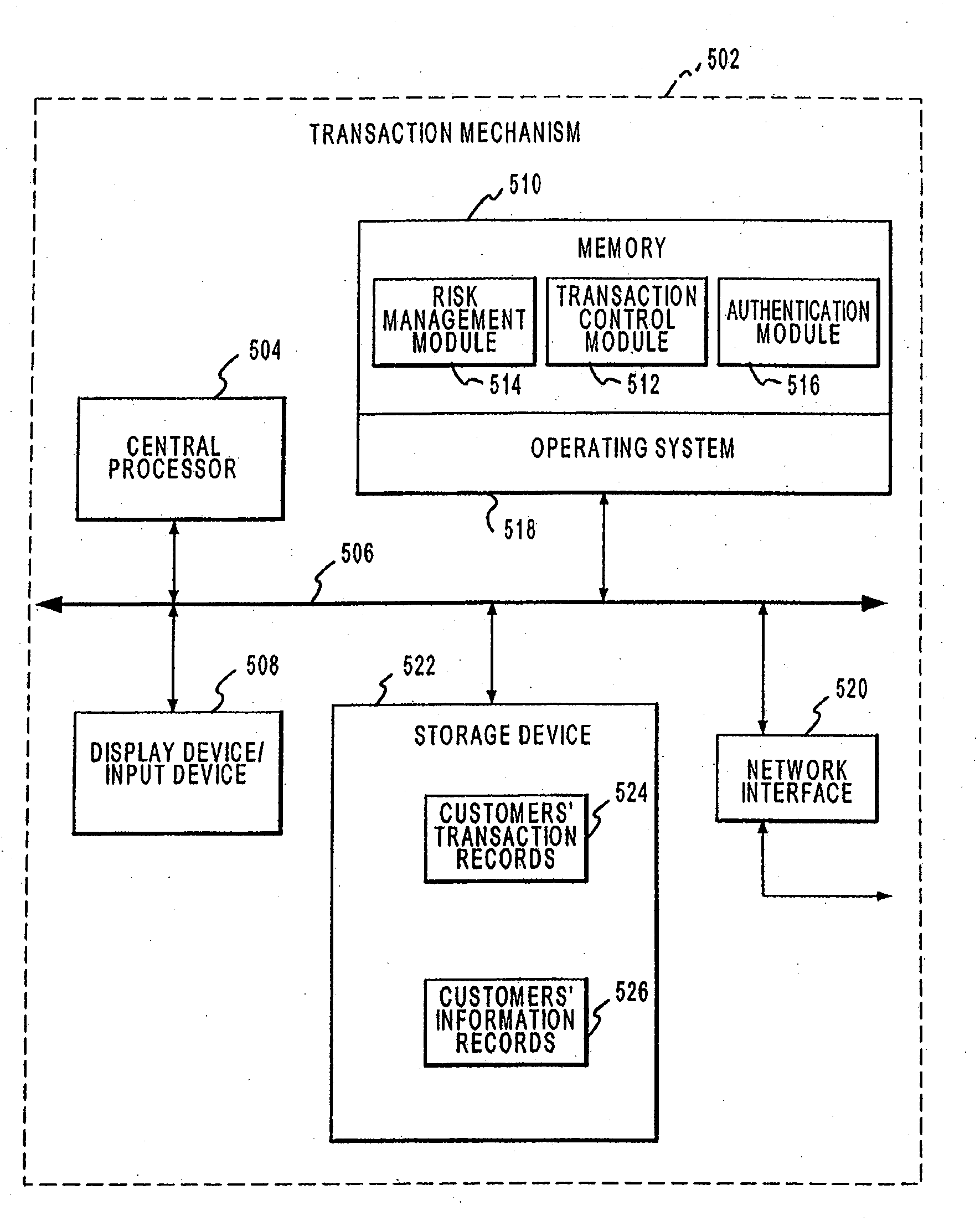

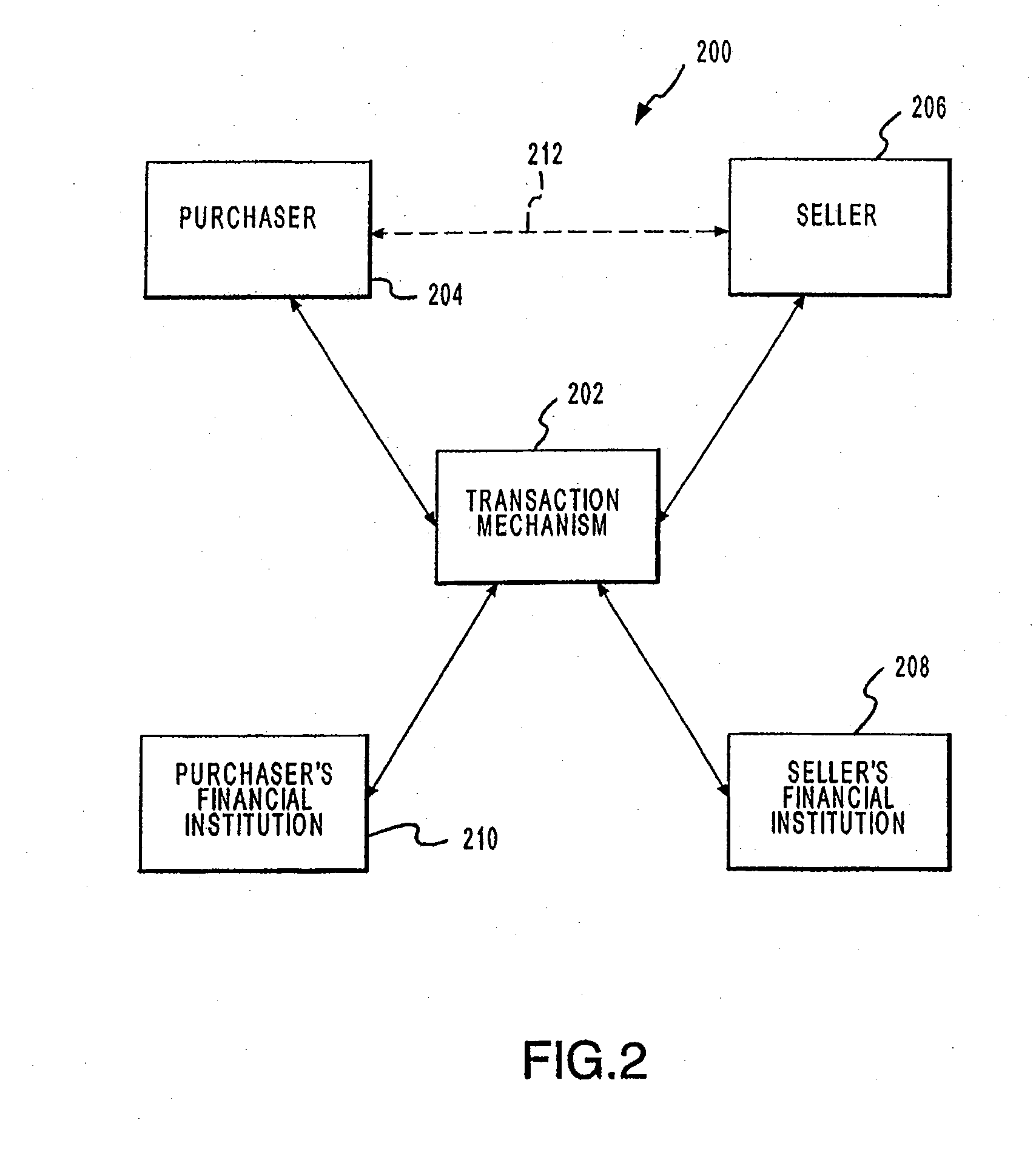

Transaction Processing Method, Apparatus and System

InactiveUS20090099961A1Takes burdenImprove securityComplete banking machinesFinanceIssuing bankPayment transaction

The present invention relates to transaction processing, for processing of payments between payer's (usually individual payers) and payee's (usually merchants. Conventionally, a payment transaction involves a user's account details being provided to a merchant device, e.g. by swiping a card in the card swipe of the merchant device. The merchant device then prepares a transaction message including information such as the user's account ID, merchant ID and payment information and forwards that message to a transaction processing system, which may comprise a transaction acquirer and an issuing bank. The transaction processing system approves the payment and returns confirmation to the merchant. In the present invention a device associated with the payer, which in a preferred embodiment is a suitably adapted mobile telephone, becomes involved in the payment transaction process. At one level, the transaction processing system requests from the payer electronic device confirmation that the transaction should proceed and the payer keys in an appropriate PIN to authorise the transaction. At another level, all the transaction processing information is provided from the payer electronic device to the transaction processing system and the transaction processing system or the payer electronic device then confirm that the transaction is authorised to the merchant device. This takes the burden of transaction processing off the merchant and also increases the security of the transaction as the payer is in control. In a further embodiment, the payer electronic device may also upload listings of products and select products at the same time as paying for them, the payee (merchant) being advised of the selected product.

Owner:OGILVY IAN CHARLES

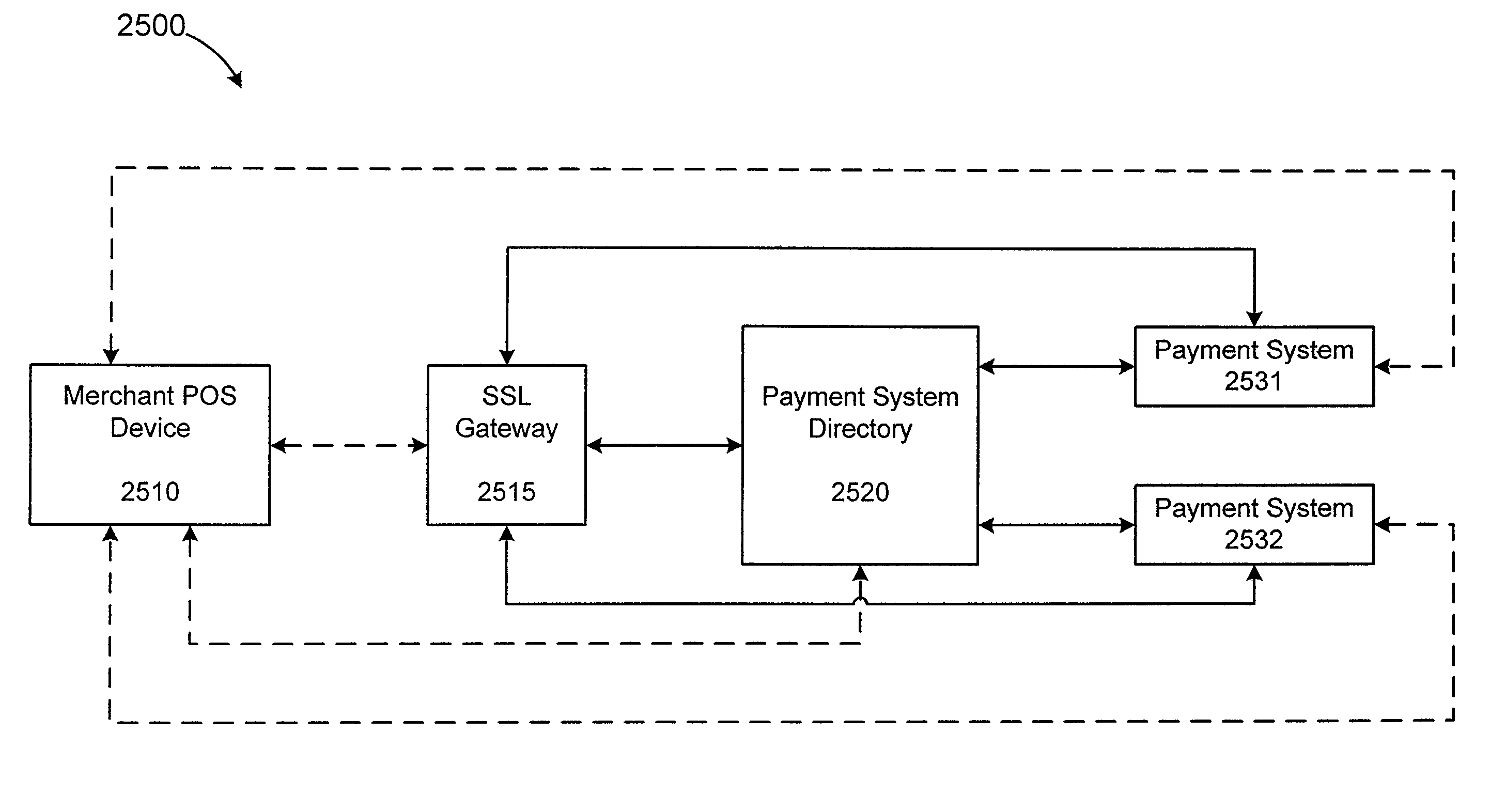

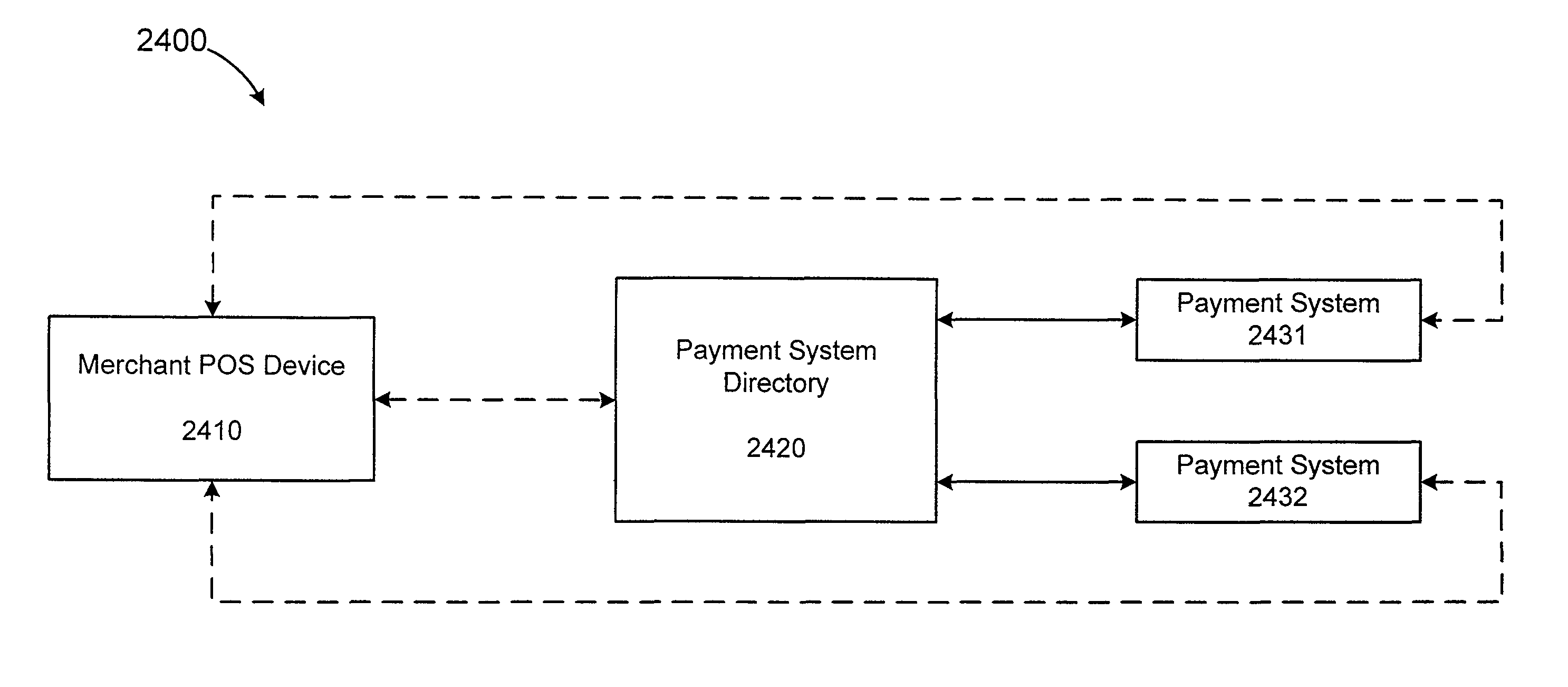

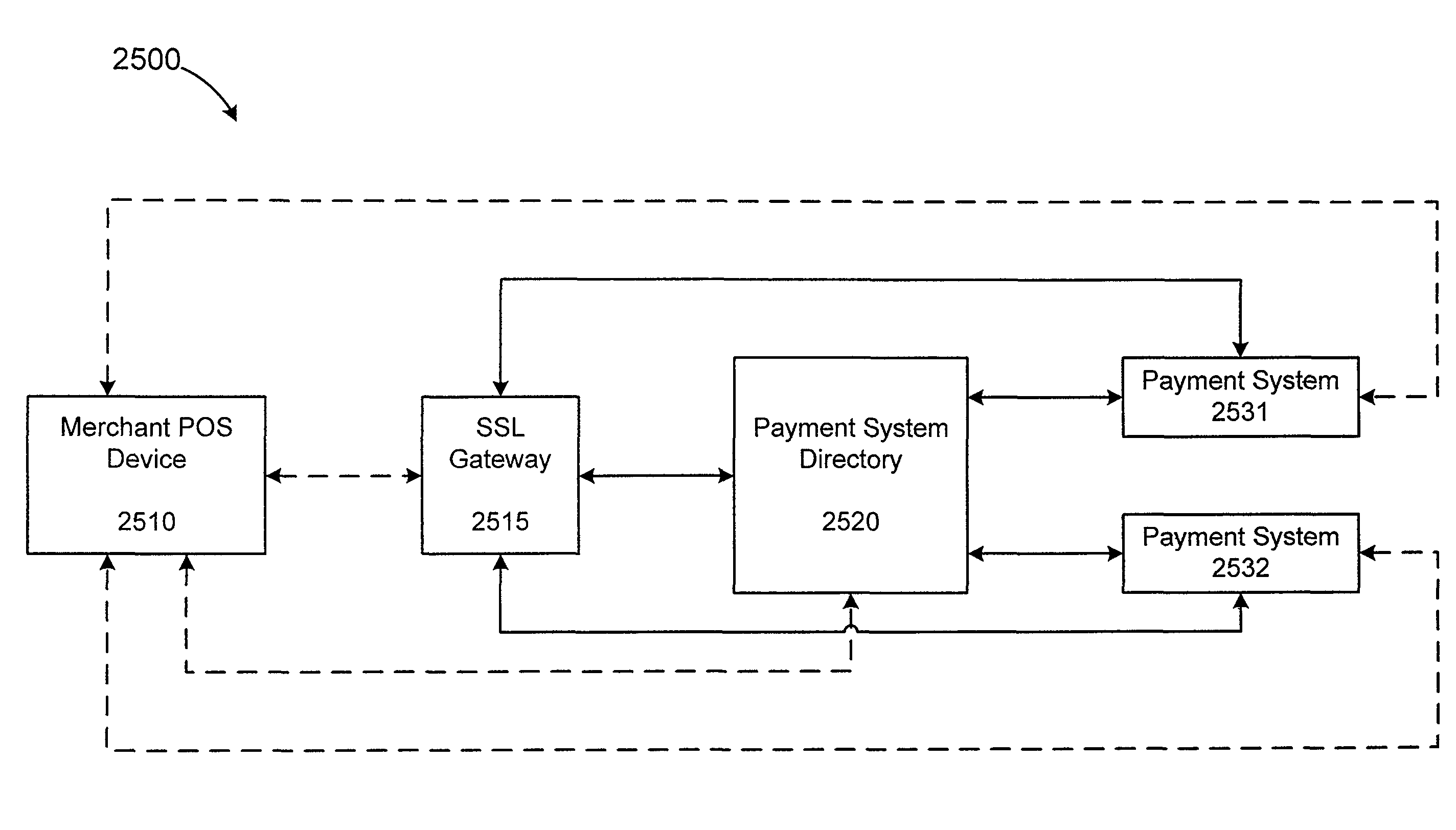

Methods for processing a payment authorization request utilizing a network of point of sale devices

InactiveUS8814039B2Easy to identifyEasy to calculateComplete banking machinesHand manipulated computer devicesThird partyIssuing bank

A point of sale (POS) device may be configured to locate a payment system and transmit a payment authorization request from a remote location to a payment system, either directly, or via a payment system directory and / or a SSL Gateway. The invention also includes inserting third party account information into an encrypted portion of the payment request, so the payment request appears as a normal request to the issuing bank, but the third party account information may be used by the third party to bill the customer. The payment system directory is further configured to determine one or more payment processors to direct a payment authorization request, such that a single transaction may me allocated among multiple payment processors for authorization. Moreover, the payment system directory is able to format alternative payment methods into a format that is able to be processed over existing payment networks.

Owner:LIBERTY PEAK VENTURES LLC

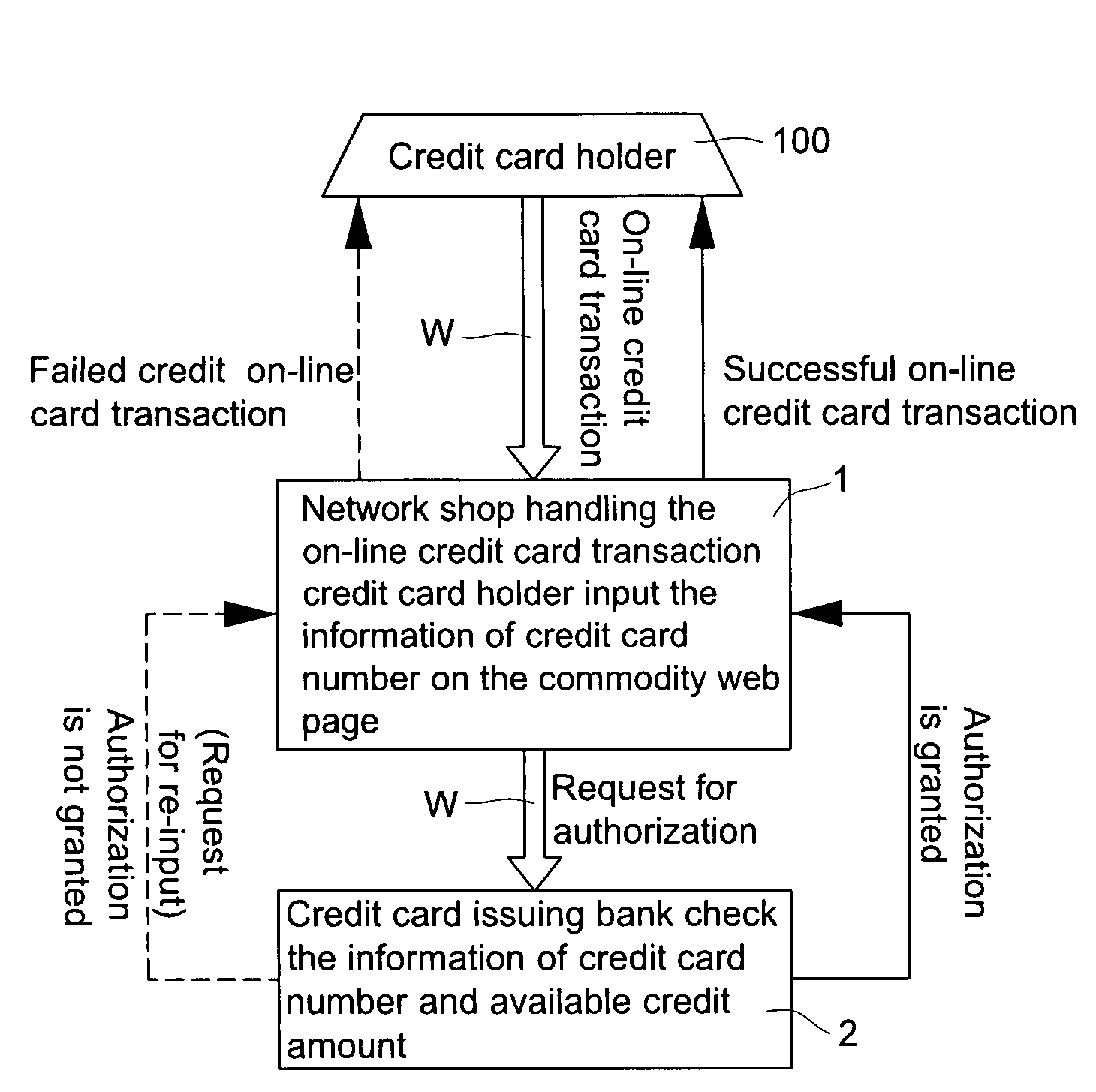

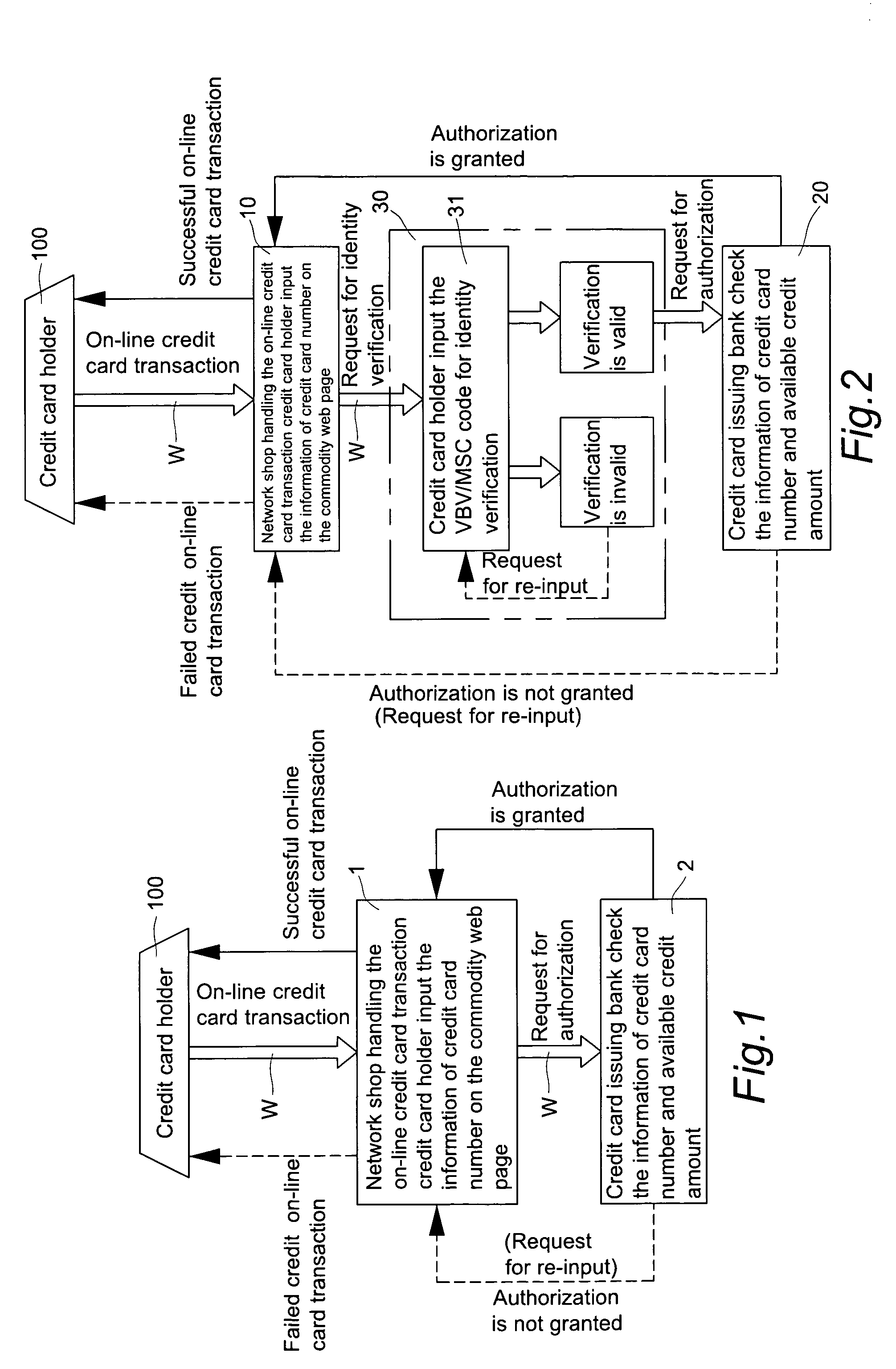

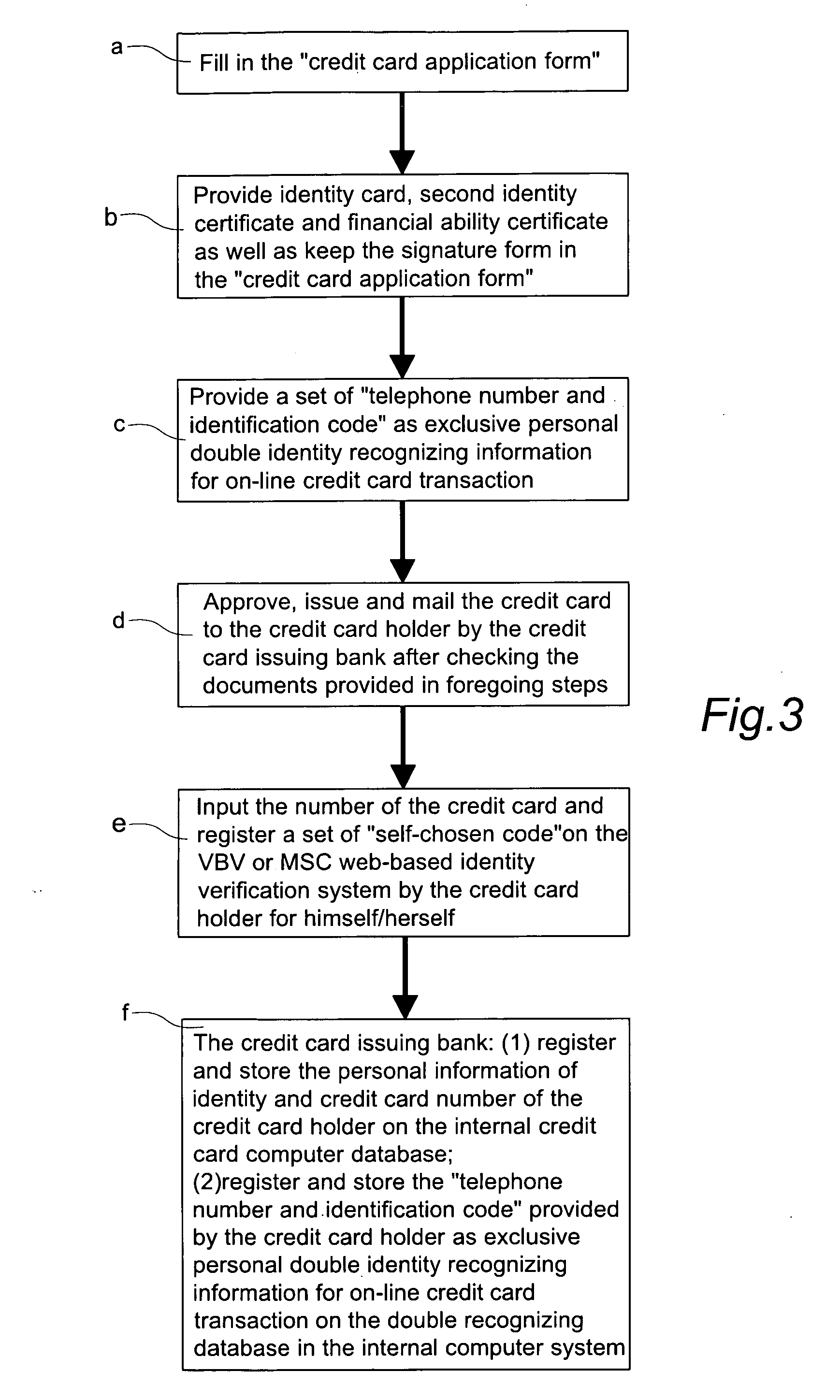

Double recognizing method by means of telephone number and identification code for online credit card transactions over the internet

The present invention relates to a “double recognizing method by means of telephone number and identification code for online credit card transactions over the internet,” in which the credit card holder not only registers a “self-chosen code” by himself / herself for VBV (Verified By VISA) or MSC (MasterCard SecureCode) network identity verification but also registers another set of “telephone number and identification code” by himself / herself for serving as an exclusive personal double identity recognizing information for online credit card transactions. The credit card issuing bank registers and stores the set of “telephone number and identification code” on a double recognizing database after checking truth of the related identity certificate provided by the credit card holder. When the credit card issuing bank handles the online credit card transaction of the credit card holder over the network, the credit card issuing bank not only proceeds the check on the “self-chosen code” used in the original VBV or MSC verification system but also performs the double check on the “telephone number and identification code” used in the telecommunications transceiving processor platform of the internal credit card double recognizing computer system, for example by sending out a short message to the credit card holder for requesting him / her to immediately reply by another short message to his / her “telephone number and identification code.”

Owner:LIN CHUNG YU

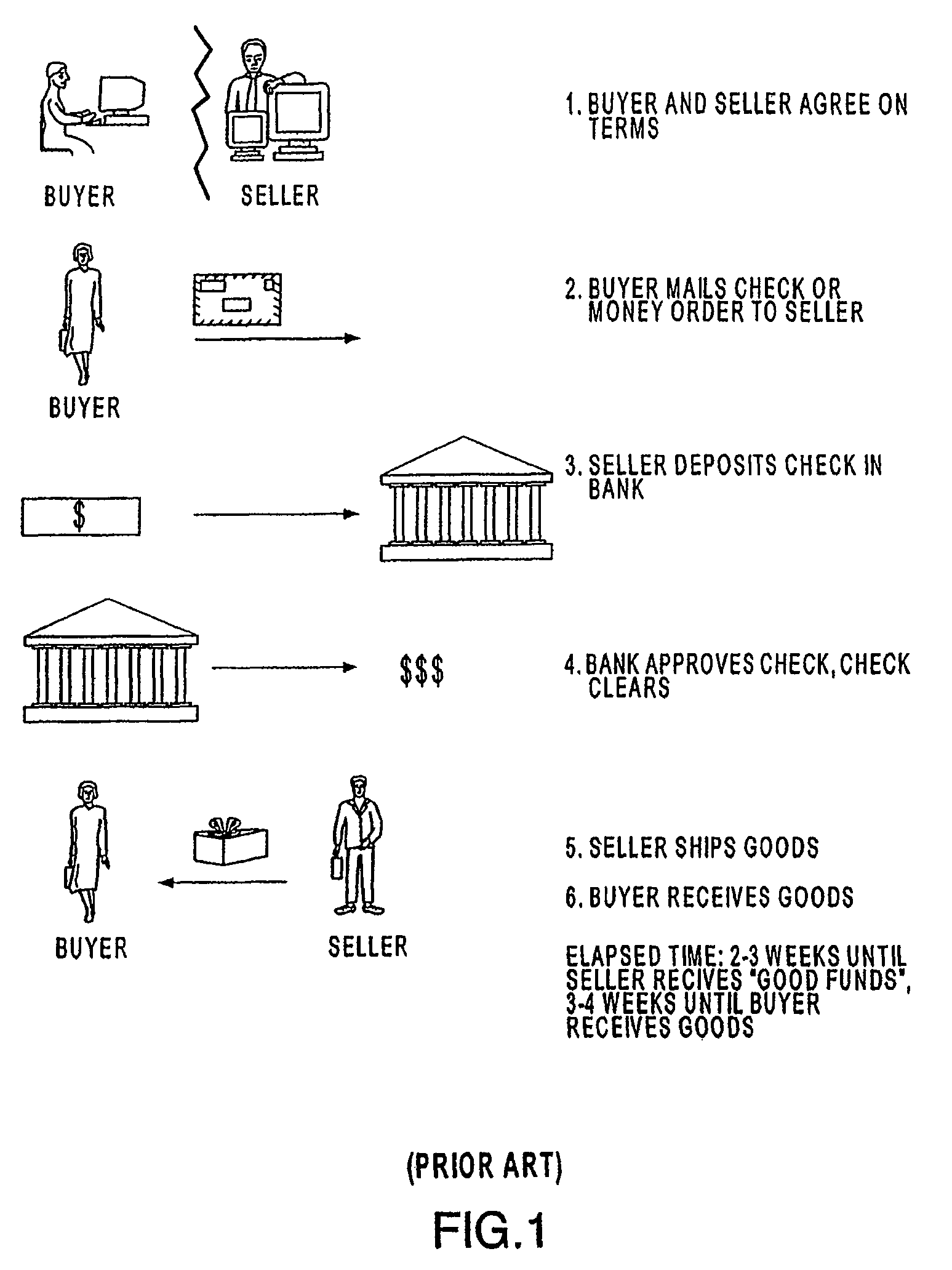

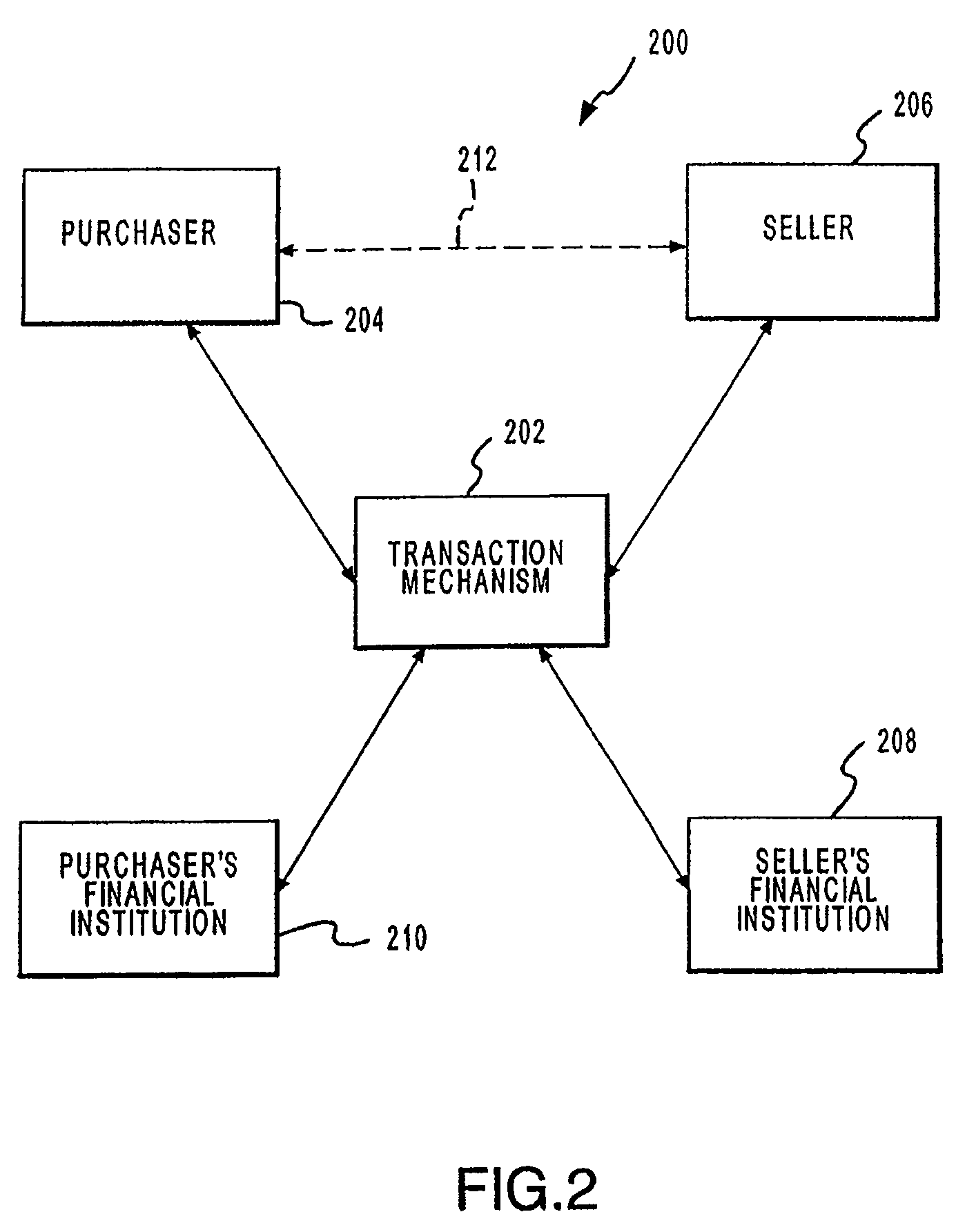

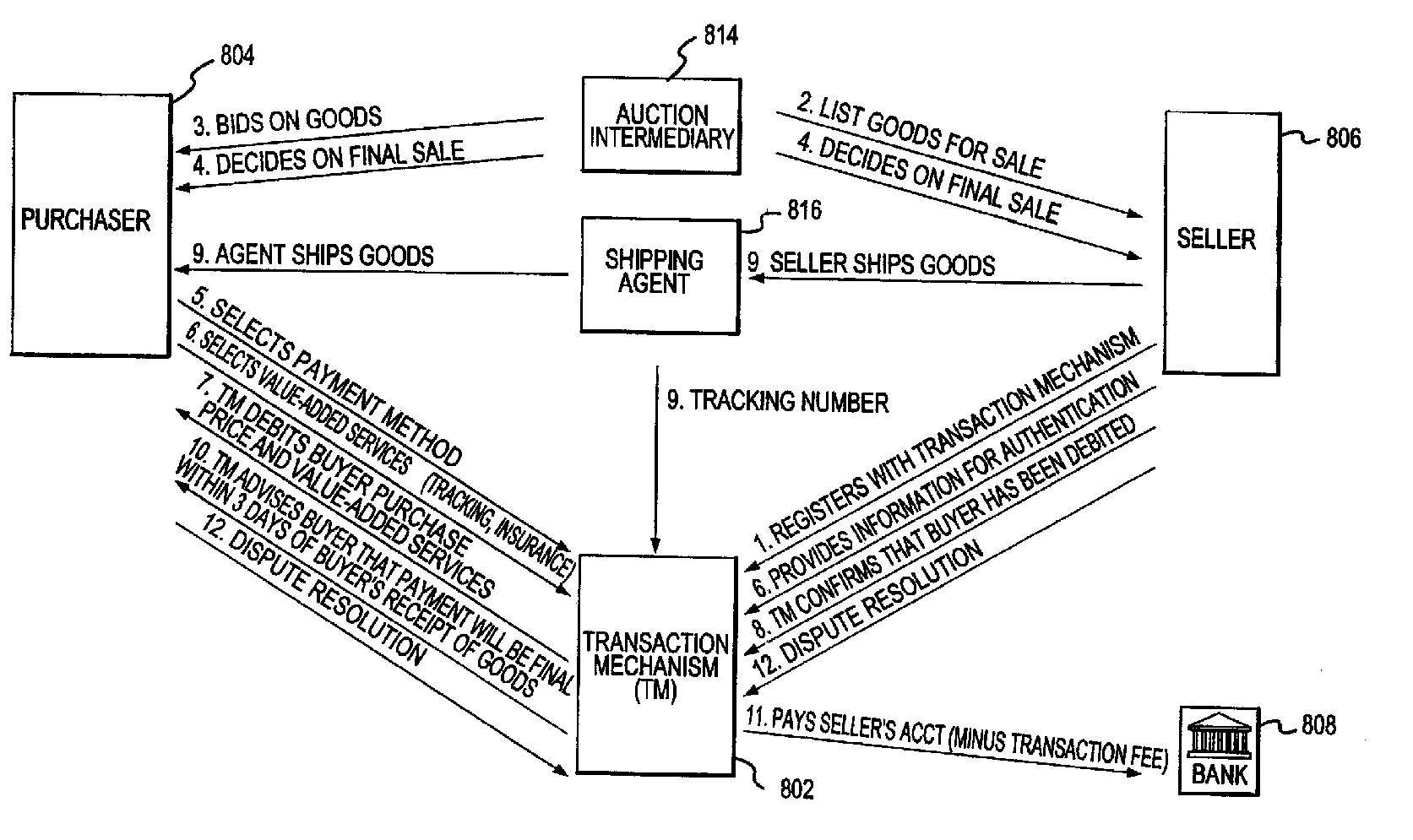

Method and system for issuing, aggregating and redeeming points based on merchant transactions

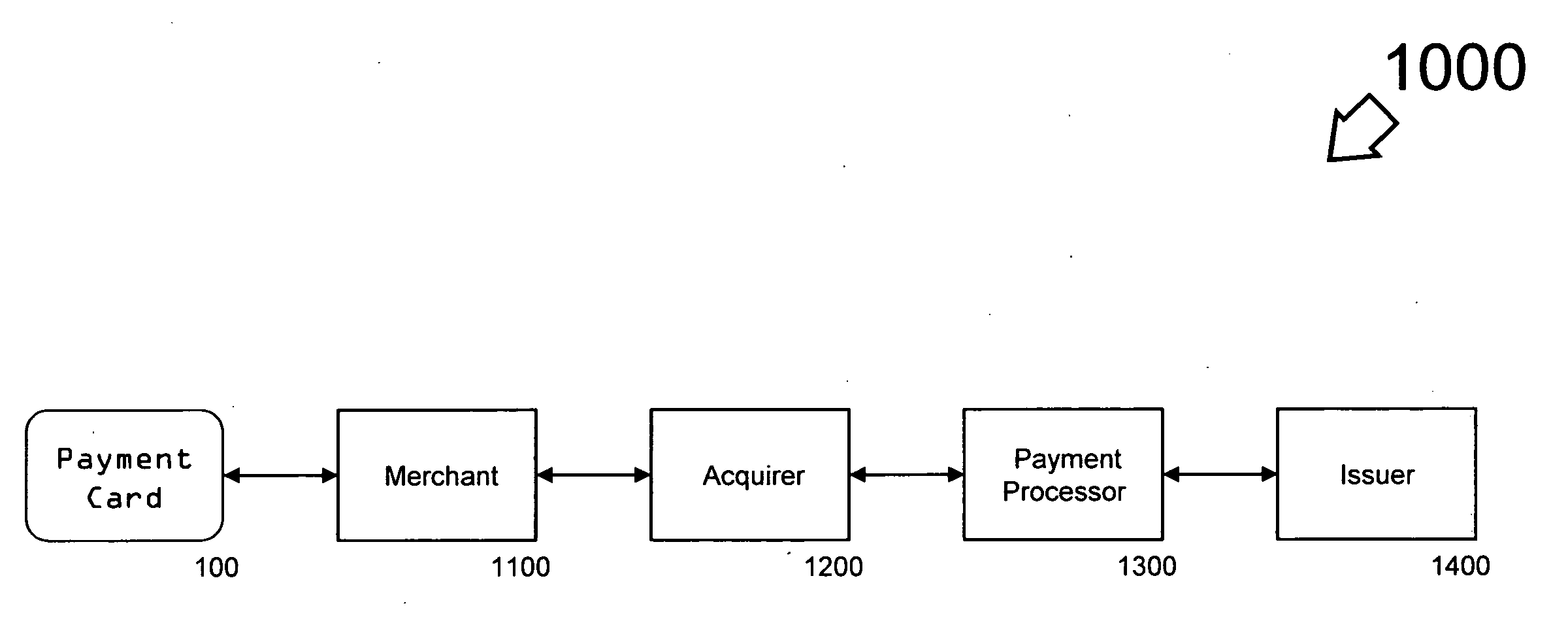

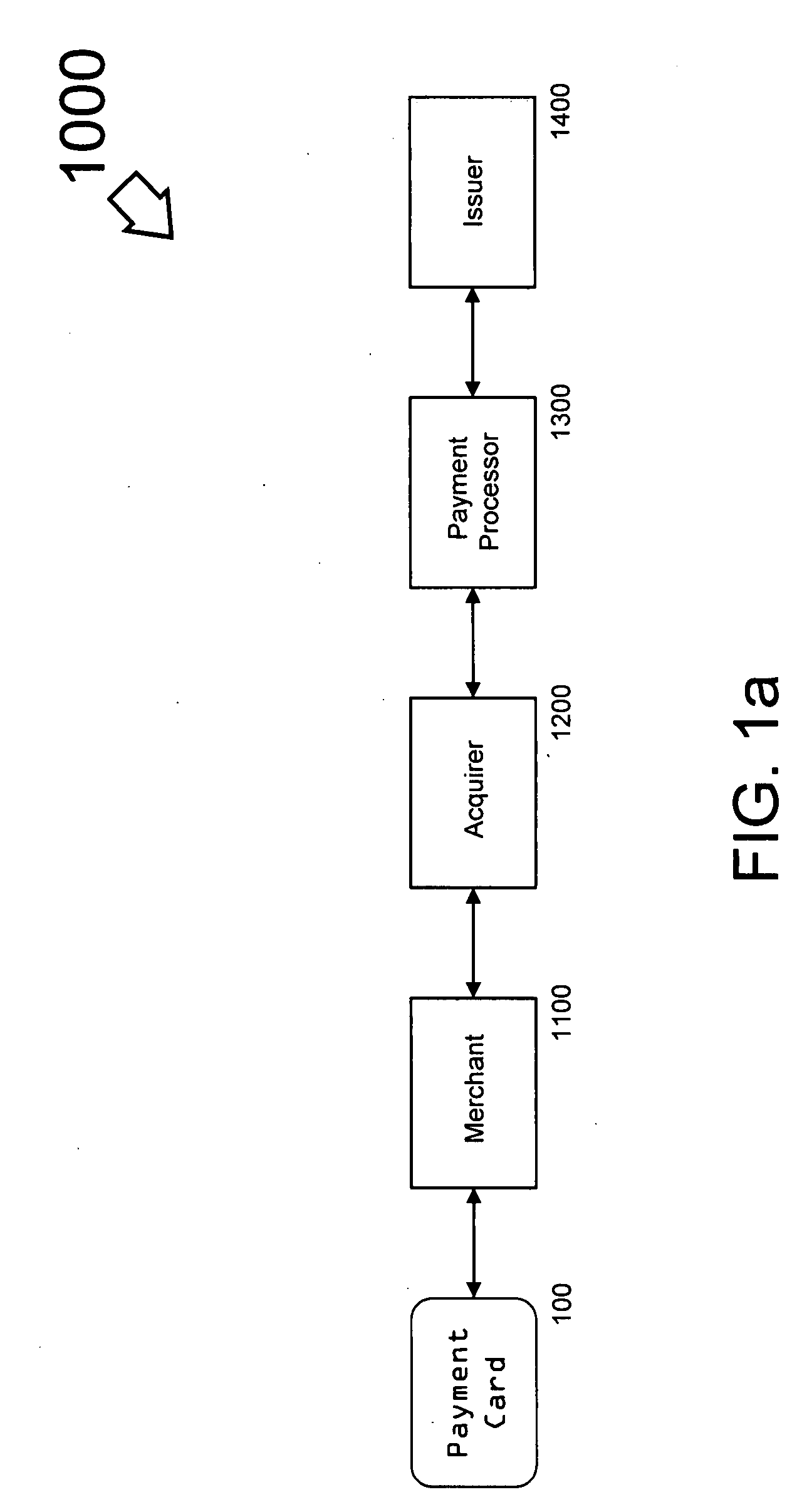

A loyalty or reward point system that utilizes the pre-existing infrastructure of a typical credit card network. In one embodiment, a user makes a purchase at a merchant of a product using a credit card. The merchant contacts the acquiring bank (which may be any type of financial institution but is referred to generically herein as a bank) with which it has contracted for credit card network services, and as known in the art, will get an approval or decline message after the acquiring bank contacts the issuing bank of the credit card used by the purchaser. Assuming that the purchase transaction is approved, the user is awarded loyalty points from the merchant based on the amount of the purchase (e.g. 100 points for a $100 purchase). A central server resides on the credit card network and tracks the transaction between the merchant, the acquiring bank, and the issuing bank. A reward account is maintained on the central server on behalf of the merchant and the user, and the number of reward points in the user's account for that merchant is increased accordingly. In an alternative embodiment, the user's reward points are logged in an account maintained by the acquiring bank on behalf of the merchant (with which it has a contractual relationship) and the user. The user may redeem the reward points earned from the transaction with the merchant at a later time, or may redeem the points with another merchant on the credit card network, or may aggregate those reward points with those of other merchants into a central exchange account, and then redeem the aggregated points for goods or services from any approved merchant on the network, depending on the configuration of the system.

Owner:SIGNATURE SYST

Systems and methods for processing a payment authorization request over disparate payment networks

InactiveUS8794509B2Easy to identifyEasy to calculateComplete banking machinesHand manipulated computer devicesIssuing bankThird party

A point of sale (POS) device may be configured to locate a payment system and transmit a payment authorization request from a remote location to a payment system, either directly, or via a payment system directory and / or a SSL Gateway. The invention also includes inserting third party account information into an encrypted portion of the payment request, so the payment request appears as a normal request to the issuing bank, but the third party account information may be used by the third party to bill the customer. The payment system directory is further configured to determine one or more payment processors to direct a payment authorization request, such that a single transaction may me allocated among multiple payment processors for authorization. Moreover, the payment system directory is able to format alternative payment methods into a format that is able to be processed over existing payment networks.

Owner:LIBERTY PEAK VENTURES LLC

Payment card with internally generated virtual account numbers for its magnetic stripe encoder and user display

A payment card comprises an internal virtual account number generator and a user display for online transactions. Offline transactions with merchant card readers are enabled by a magnetic array positioned behind the card's magnetic stripe on the back. The internal virtual account number generator is able to program the magnetic bits encoded in the magnetic stripe to reflect the latest virtual account number. The internal virtual account number generator produces a sequence of virtual numbers that can be predicted and approved by the issuing bank. Once a number is used, it is discarded and put on an exclusion list.

Owner:FITBIT INC

Methods for Processing a Payment Authorization Request Utilizing a Network of Point of Sale Devices

InactiveUS20090164327A1Easy to identifyEasy to calculateHand manipulated computer devicesFinanceThird partyIssuing bank

A point of sale (POS) device may be configured to locate a payment system and transmit a payment authorization request from a remote location to a payment system, either directly, or via a payment system directory and / or a SSL Gateway. The invention also includes inserting third party account information into an encrypted portion of the payment request, so the payment request appears as a normal request to the issuing bank, but the third party account information may be used by the third party to bill the customer. The payment system directory is further configured to determine one or more payment processors to direct a payment authorization request, such that a single transaction may me allocated among multiple payment processors for authorization. Moreover, the payment system directory is able to format alternative payment methods into a format that is able to be processed over existing payment networks.

Owner:LIBERTY PEAK VENTURES LLC

Systems and Methods for Allocating a Payment Authorization Request to a Payment Processor

InactiveUS20090157518A1Easy to identifyEasy to calculateHand manipulated computer devicesFinanceThird partyIssuing bank

A point of sale (POS) device may be configured to locate a payment system and transmit a payment authorization request from a remote location to a payment system, either directly, or via a payment system directory and / or a SSL Gateway. The invention also includes inserting third party account information into an encrypted portion of the payment request, so the payment request appears as a normal request to the issuing bank, but the third party account information may be used by the third party to bill the customer. The payment system directory is further configured to determine one or more payment processors to direct a payment authorization request, such that a single transaction may me allocated among multiple payment processors for authorization. Moreover, the payment system directory is able to format alternative payment methods into a format that is able to be processed over existing payment networks.

Owner:LIBERTY PEAK VENTURES LLC

Method and system for issuing, aggregating and redeeming merchant rewards with an issuing bank

A loyalty reward point system that utilizes the pre-existing infrastructure of network such as a credit card network. A user makes a purchase at a merchant using a token such as a credit card. As part of the purchase transaction, the user is awarded reward points from the merchant based on the purchase, which are stored in an account associated with the merchant and the user by the issuing bank. The reward account is maintained on the issuing bank server on behalf of the merchant and the user, and the number of reward points in the user's account for that merchant is increased accordingly. The user may redeem the reward points earned from the transaction with the merchant at a later time, or may redeem the points with another merchant in the same marketing cluster, or may aggregate those reward points with those of other merchants into a reward point exchange account, and then redeem the aggregated reward points for goods or services from any approved merchant on the network, depending on the configuration of the system.

Owner:SIGNATURE SYST

Methods for a third party biller to receive an allocated payment authorization request

InactiveUS8820633B2Easy to identifyEasy to calculateComplete banking machinesHand manipulated computer devicesThird partyIssuing bank

Owner:LIBERTY PEAK VENTURES LLC

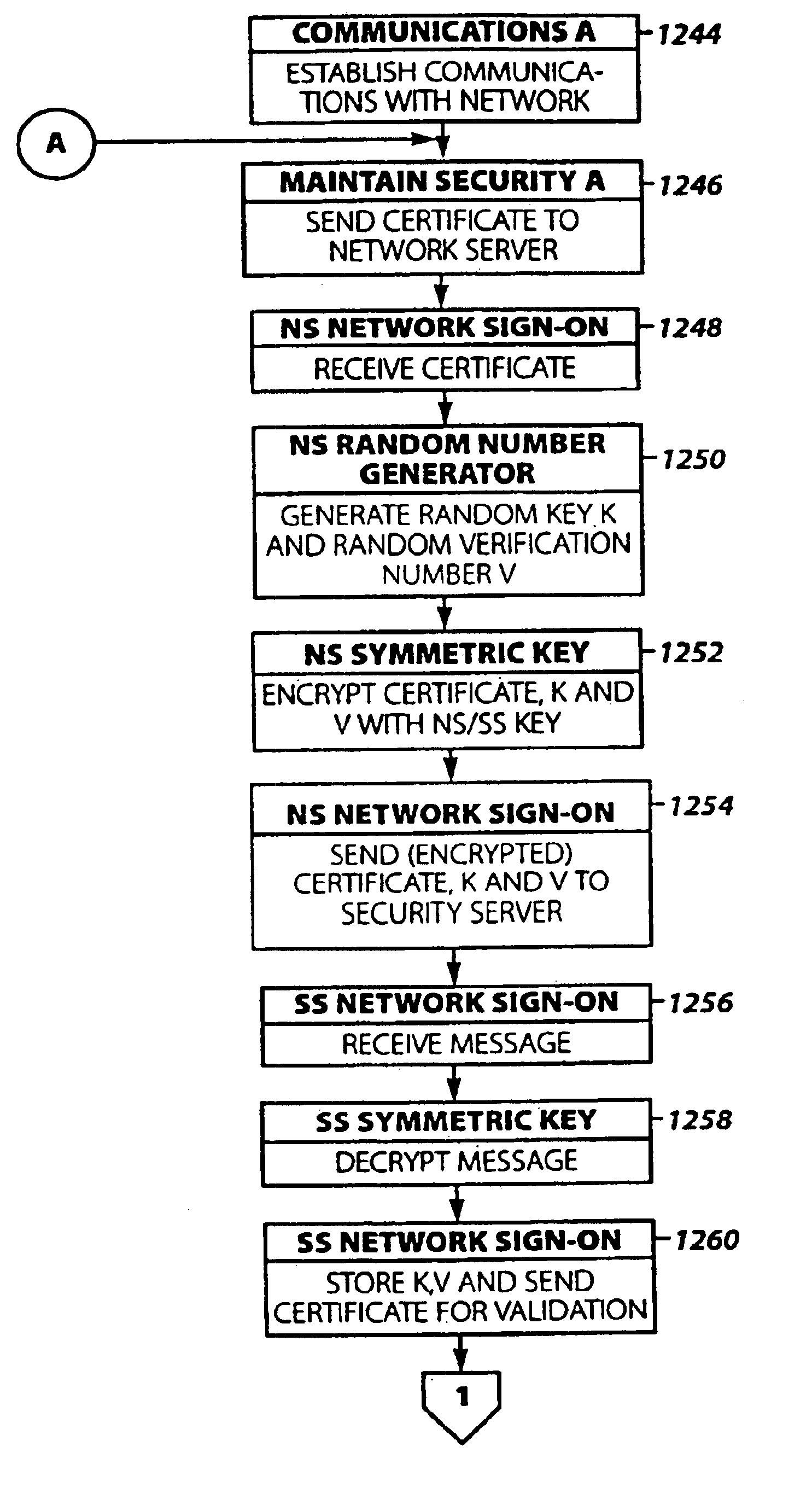

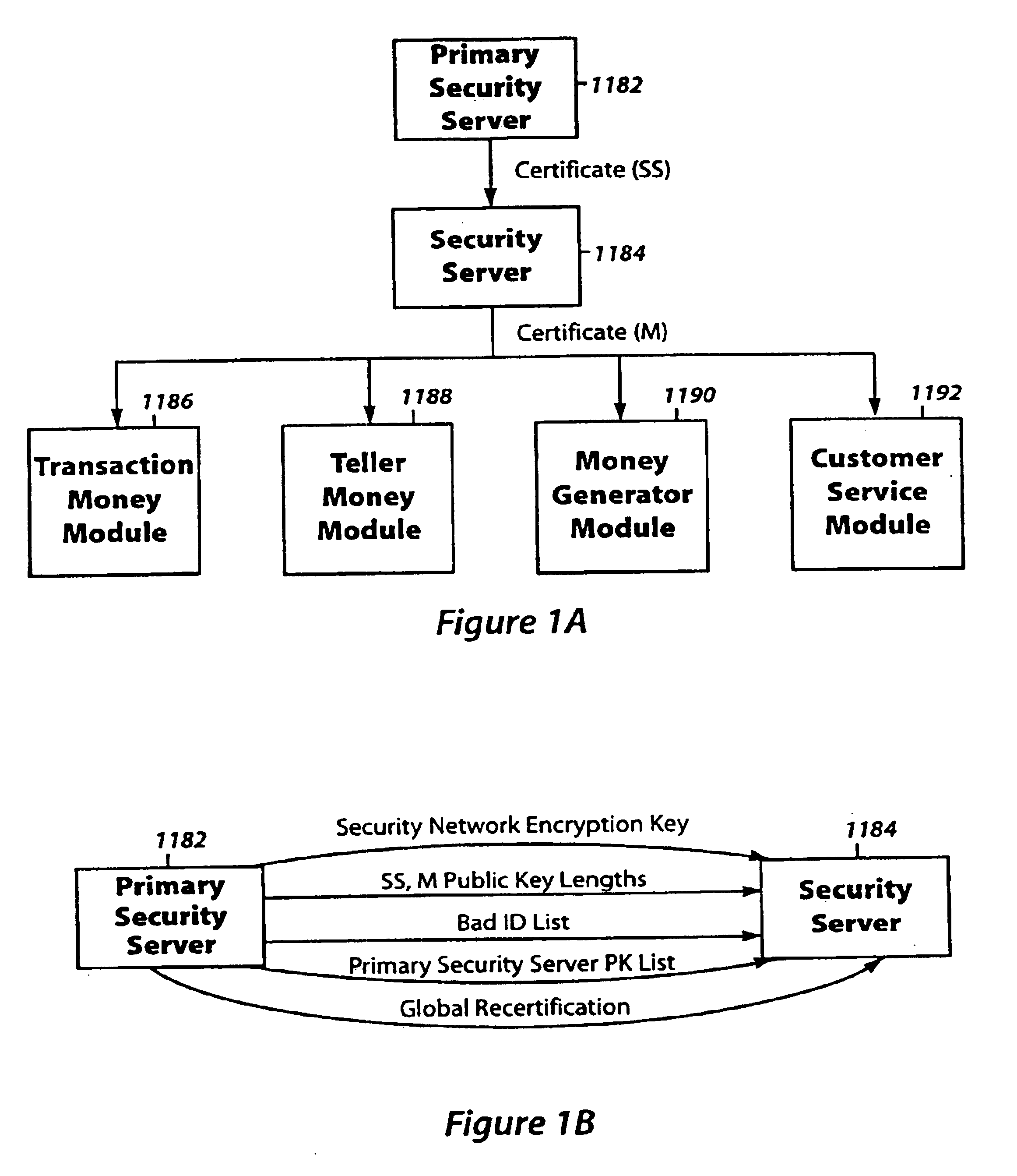

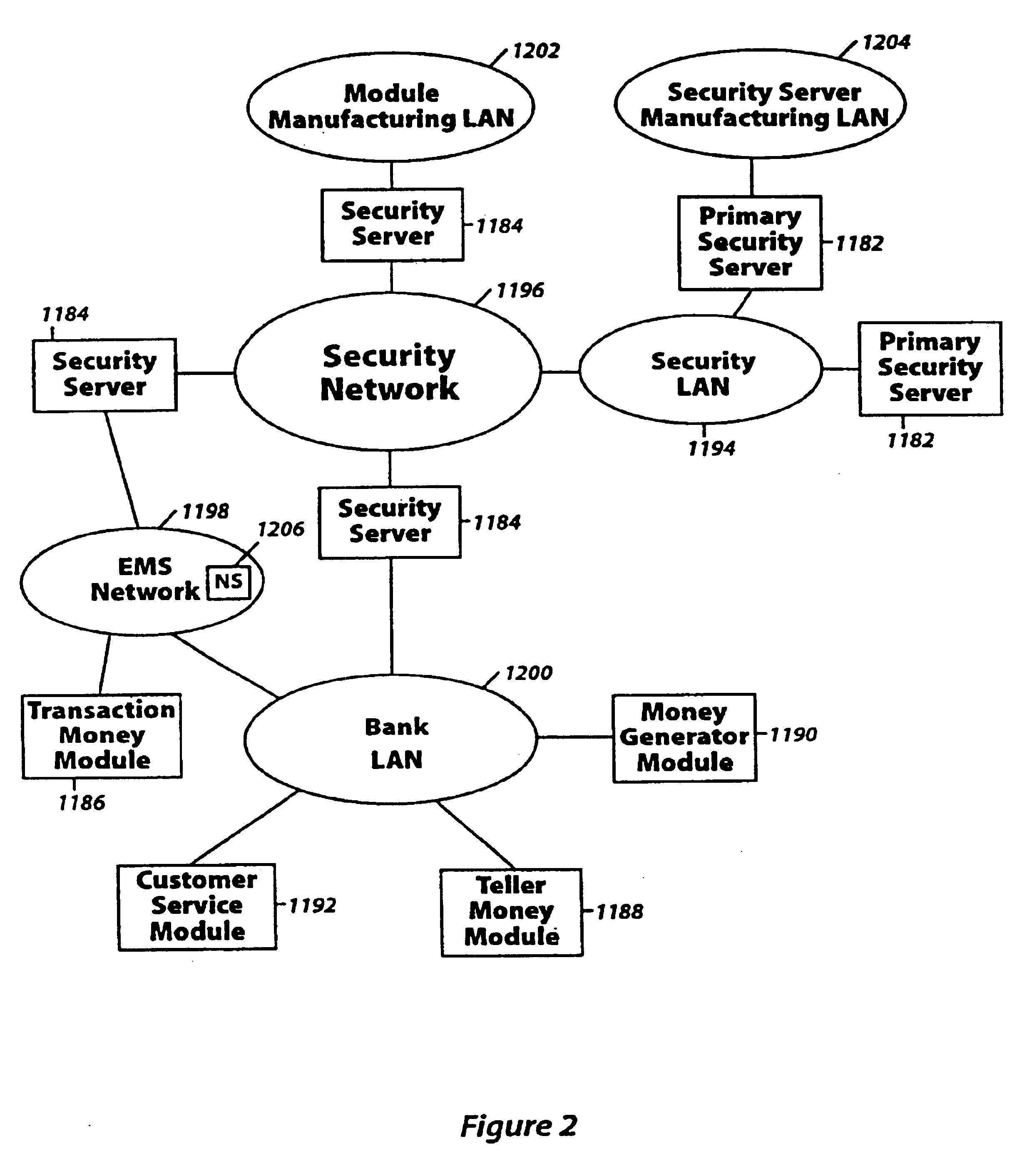

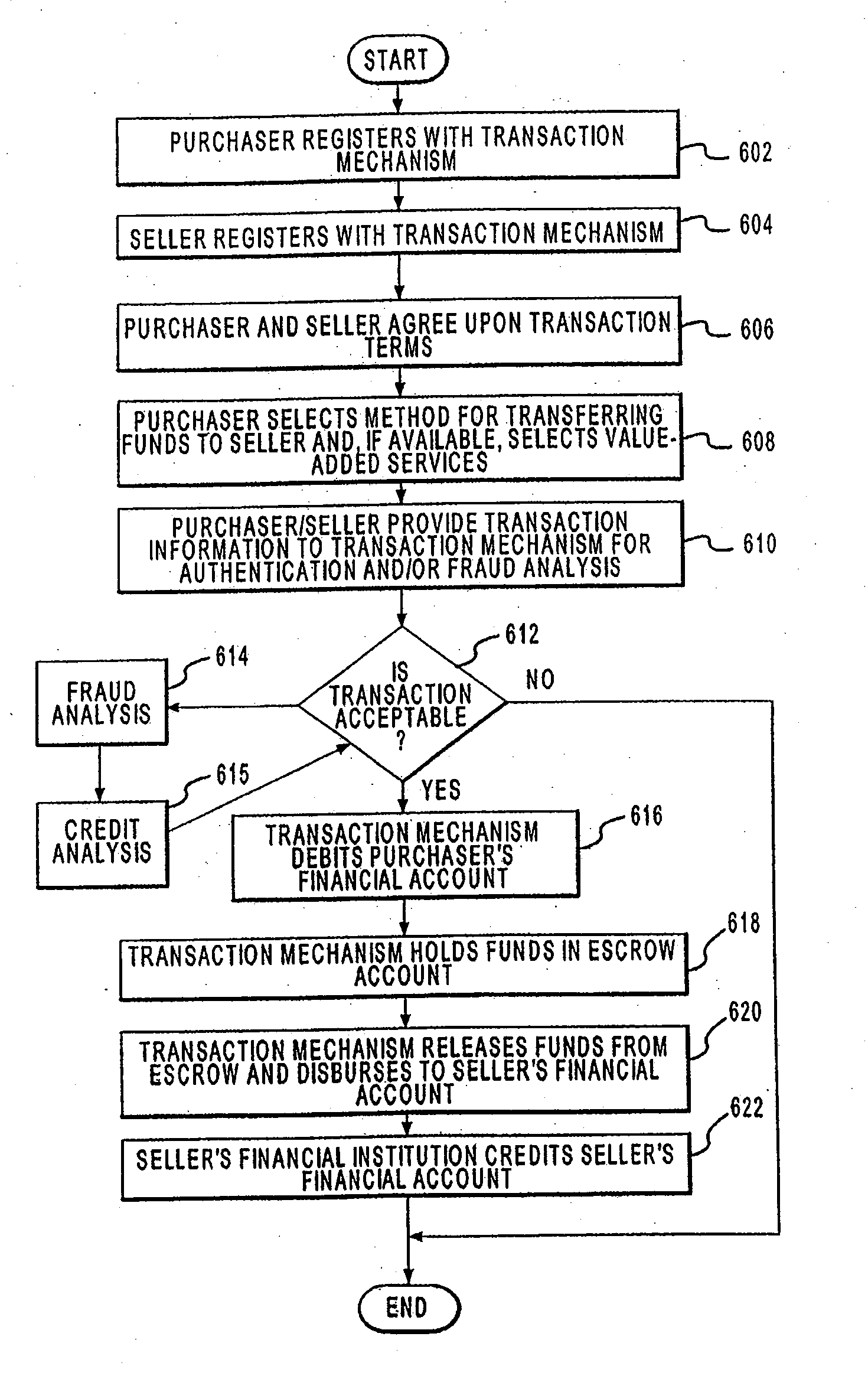

Security systems and methods applicable to an electronic monetary system

InactiveUS6868408B1Reliably purchase goodsUser identity/authority verificationComputer security arrangementsIssuing bankComputer module

An electronic-monetary system having (1) banks or financial institutions that are coupled to a money generator device for generating and issuing to subscribing customers electronic money including electronic currency backed by demand deposits and electronic credit authorizations; (2) correspondent banks that accept and distribute the electronic money; (3) a plurality of transaction devices that are used by subscribers for storing electronic money, for performing money transactions with the on-line systems of the participating banks or for exchanging electronic money with other like transaction devices in off-line transactions; (4) teller devices, associated with the issuing and correspondent banks, for process handling and interfacing the transaction devices to the issuing and correspondent banks, and for interfacing between the issuing and correspondent banks themselves; (5) a clearing bank for balancing the electronic money accounts of the different issuing banks; (6) a data communications network for providing communications services to all components of the system; and (7) a security arrangement for maintaining the integrity of the system, and for detecting counterfeiting and tampering within the system. This system includes a customer service module which handles lost money claims and links accounts to money modules for providing bank access.

Owner:CITIBANK

Methods for locating a payment system utilizing a point of sale device

InactiveUS20090164326A1Easy to identifyEasy to calculateComplete banking machinesHand manipulated computer devicesThird partyIssuing bank

A point of sale (POS) device may be configured to locate a payment system and transmit a payment authorization request from a remote location to a payment system, either directly, or via a payment system directory and / or a SSL Gateway. The invention also includes inserting third party account information into an encrypted portion of the payment request, so the payment request appears as a normal request to the issuing bank, but the third party account information may be used by the third party to bill the customer. The payment system directory is further configured to determine one or more payment processors to direct a payment authorization request, such that a single transaction may me allocated among multiple payment processors for authorization. Moreover, the payment system directory is able to format alternative payment methods into a format that is able to be processed over existing payment networks.

Owner:LIBERTY PEAK VENTURES LLC

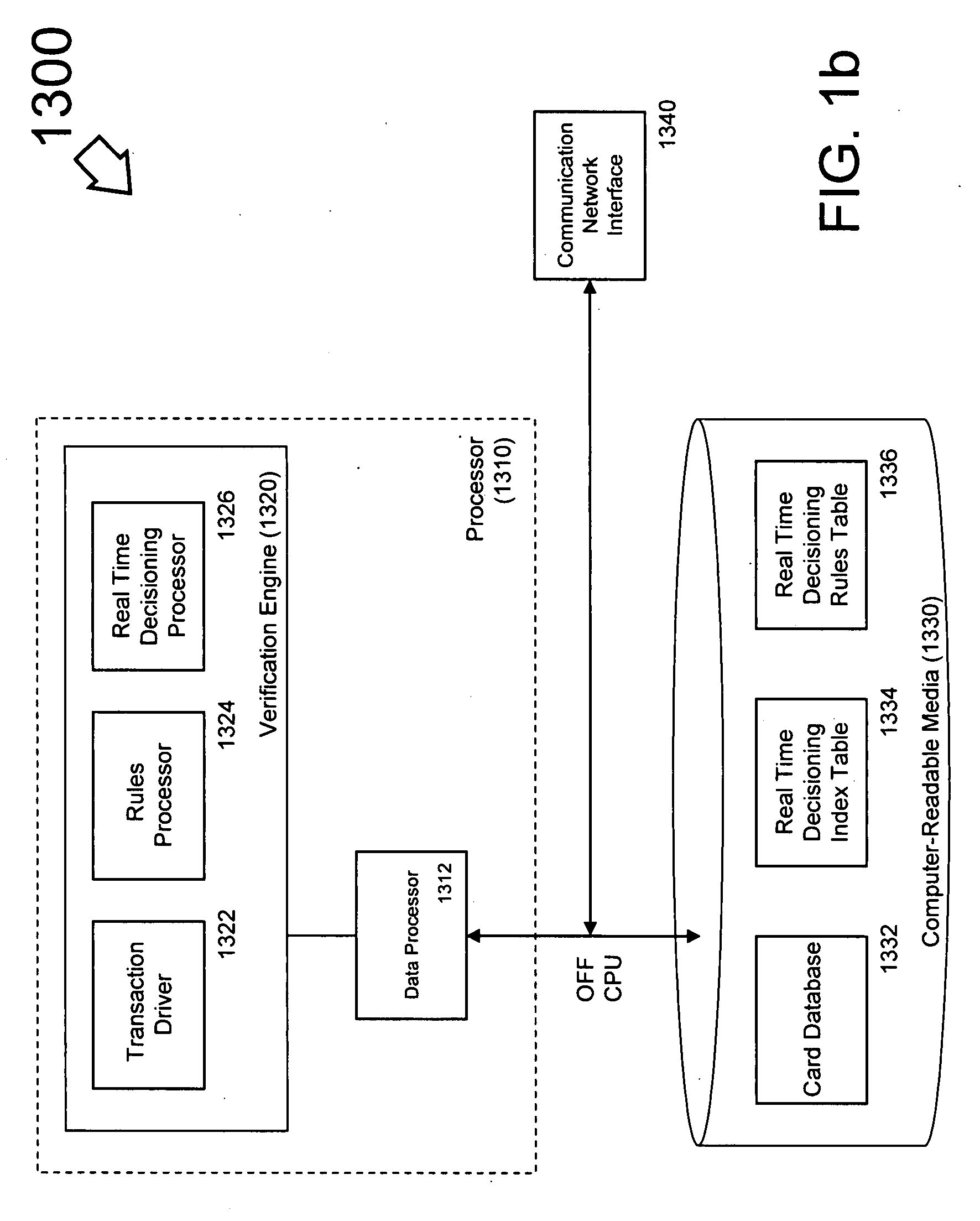

Fraud prevention based on risk assessment rule

A system, method, and computer-readable storage medium configured to import fraud prevention rules from an issuer and implement them in real-time at a payment processor. Usually, a card issuing bank either approves or declines financial transaction; however, in embodiments of the present invention, the issuing bank creates fraud prevention rules, and the payment processor implements the created rules. A payment processor apparatus comprises a network interface, and a verification engine. The verification engine includes a transaction driver, and a real time decisioning processor. The network interface is configured to receive a fraud prevention rule from a payment card issuing bank, and to receive a proposed financial transaction from an acquiring bank. The transaction driver receives the fraud prevention rule. The real time decisioning processor compares the proposed financial transaction from the acquirer and the fraud prevention rule to determine whether the proposed financial transaction should be declined.

Owner:VISA USA INC (US)

Certificate of deposit portfolio system and method

InactiveUS20050114246A1Low costRaise interest ratesFinanceSpecial data processing applicationsIssuing bankEngineering

A certificate of deposit (“CD”) portfolio system and method to attract institutional investors through dealers to CD issuing small to medium sized community deposit taking institutions. The central entities of the system include a system operator and a system clearing house. The system operator contacts and signs up the institutions to become a part of the system. These institutions are community banks that are too small to individually attract institutional investors. It also contacts and signs up dealers and then unitizes FDIC insured CD's into single investment instrument portfolios which the dealers then market to their institutional investor clientele. The clearing house is in communication with the system operator, the institutions and the dealers to act as an agent facilitating transactions by issuing the CD's, handling funds, settling transactions, and acting as custodian / trustee for all transactions. The invention includes a system operator controlled internet website to provide access to information to for the use of CD issuing banks, the system clearing house, the system operator and the dealers. In effect the invention creates a meeting place for small banks to pool their FDIC insured CD's together into single investment instrument portfolios large enough to attract institutional investors at favorable interest rates because of the credit enhancement resulting from full FDIC insurance of the portfolio. This is achieved because the system and method prevent exceeding the $100,000.00 FDIC insurance limit per investor per bank.

Owner:INSTIONAL DEPOSITS

Method and system for issuing, aggregating and redeeming merchant rewards

A loyalty reward point system that utilizes the pre-existing infrastructure of network such as a credit card network. A user makes a purchase at a merchant using a token such as a credit card. The user is awarded loyalty points from the merchant based on the amount of the purchase (e.g. 100 points for a $100 purchase). The reward points, which are specific to the merchant and the user, are stored in a database at the issuing bank, the acquiring bank, or a central reward server. The user may redeem the reward points earned from the transaction with the merchant at a later time, or may redeem the points with another merchant in the same marketing cluster, or may aggregate those reward points with those of other merchants into a reward point exchange account, and then redeem the aggregated reward points for goods or services from any approved merchant on the network, depending on the configuration of the system.

Owner:SIGNATURE SYST

Systems and methods for locating a payment system utilizing a wireless point of sale device

Systems and methods to facilitate commercial transactions conducted at geographically remote locations is disclosed. A wireless point of sale (POS) device may be configured to locate a payment system and transmit a payment authorization request from a remote location to at least one payment system, either directly, or via a payment system directory and / or a SSL Gateway. The invention also includes inserting third party account information into an encrypted portion of the payment request, so the payment request appears as a normal request to the issuing bank, but the third party account information may be used by the third party to bill the customer.

Owner:LIBERTY PEAK VENTURES LLC

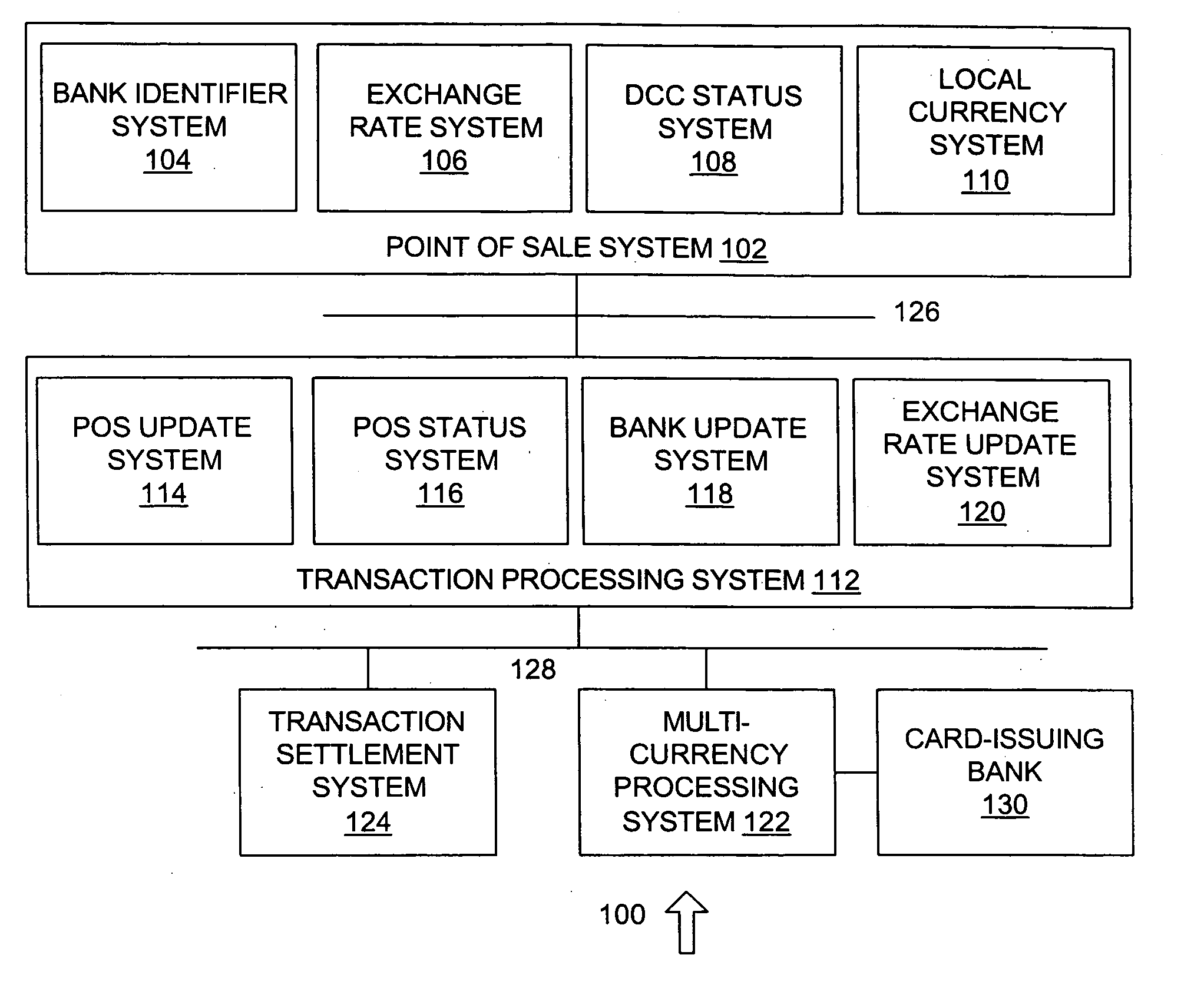

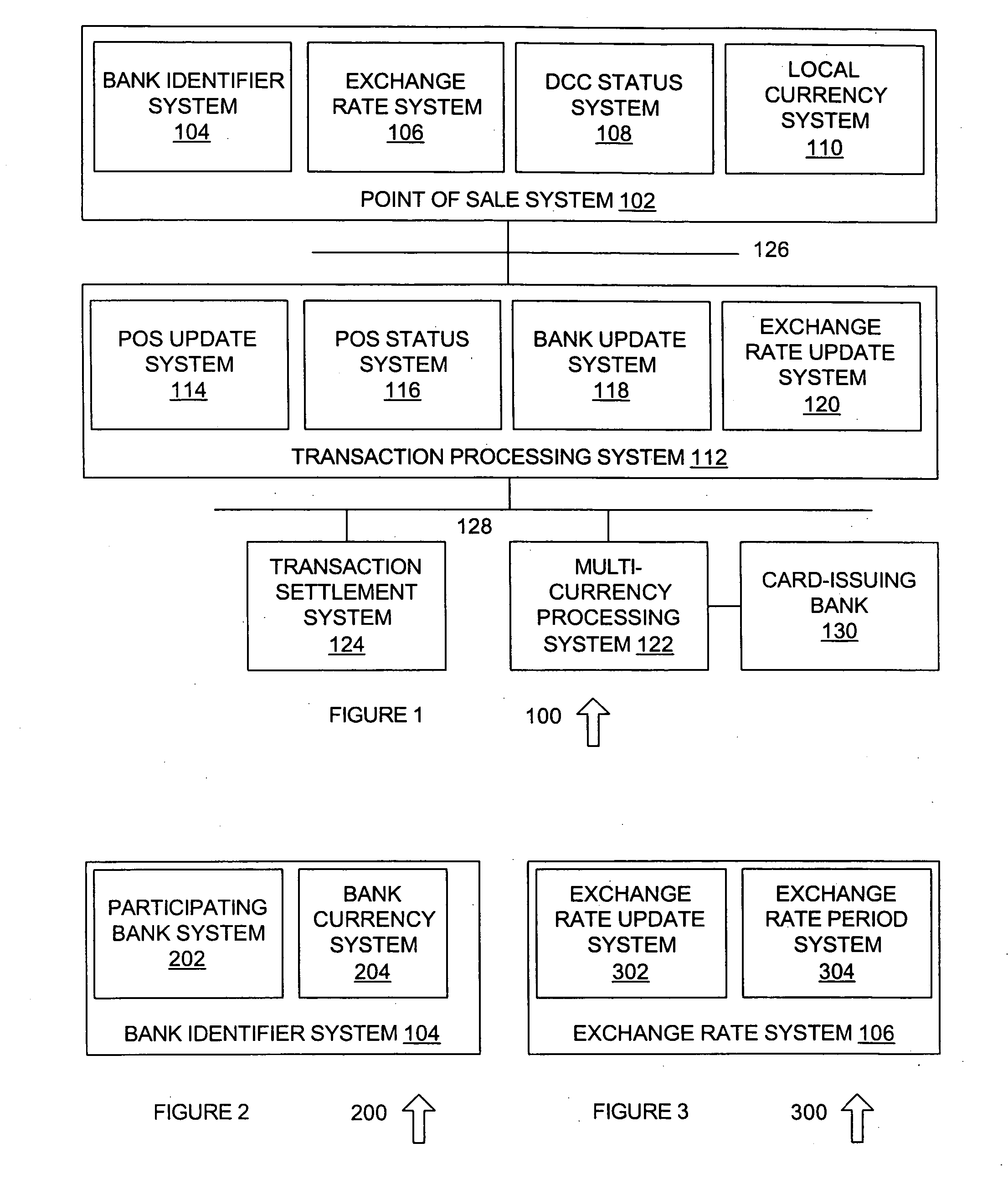

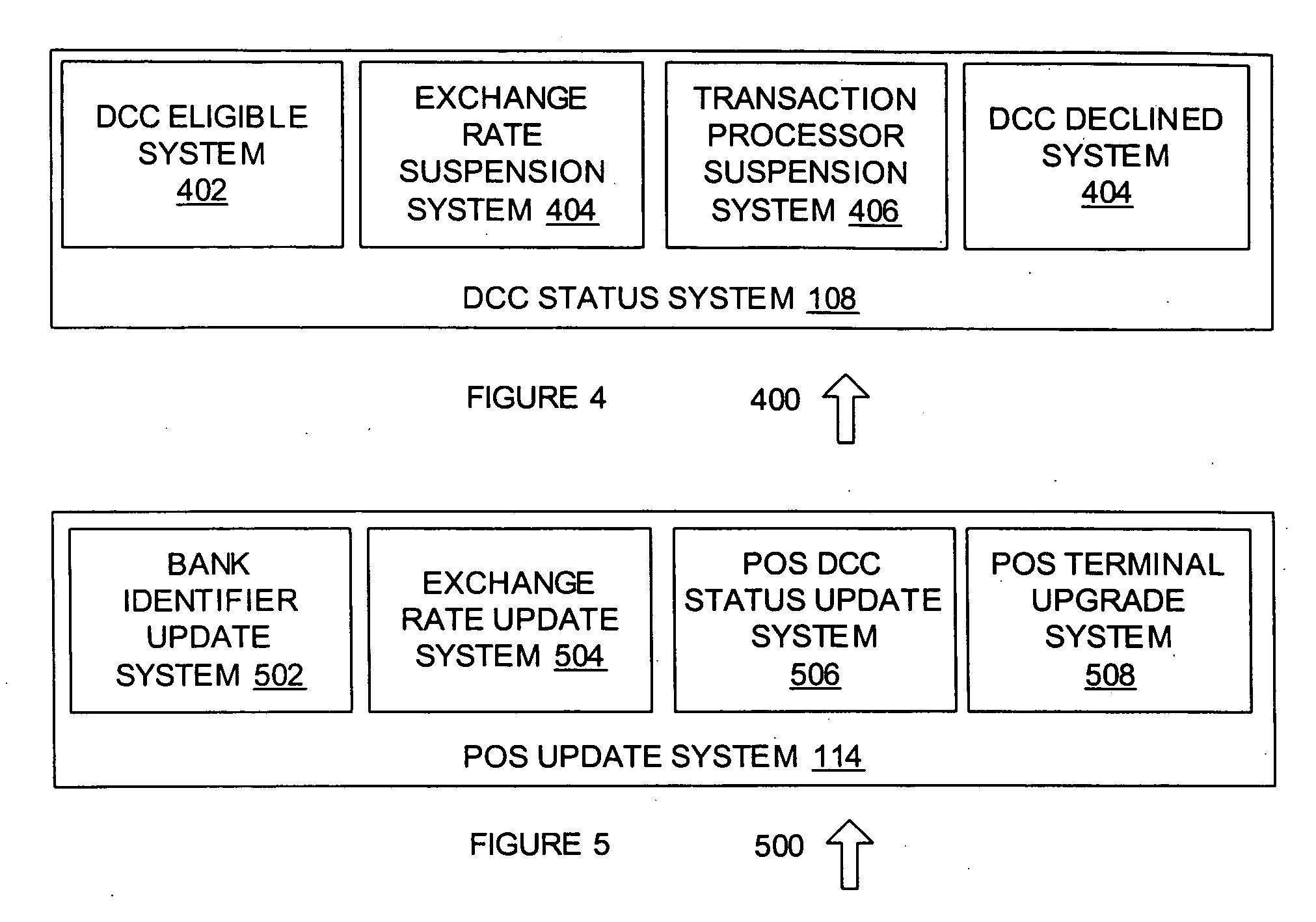

Dynamic currency conversion system and method

A system for dynamic currency conversion is provided. The system includes a bank identifier system determining whether currency conversion is available for a card-issuing bank of a presented card, such as by comparing a bank identifier from the card with a list or table of participating banks. An exchange rate system determines whether an exchange rate has expired, such as an exchange rate associated with the foreign currency of the card-issuing bank. The card holder is presented with an option for selecting a foreign currency transaction after it is determined that currency conversion is available for the card-issuing bank and that the exchange rate has not expired, such that the card holder does not need to see such information unless foreign currency processing is available.

Owner:PAYMENTECH INC

Method and system for securing payment transactions

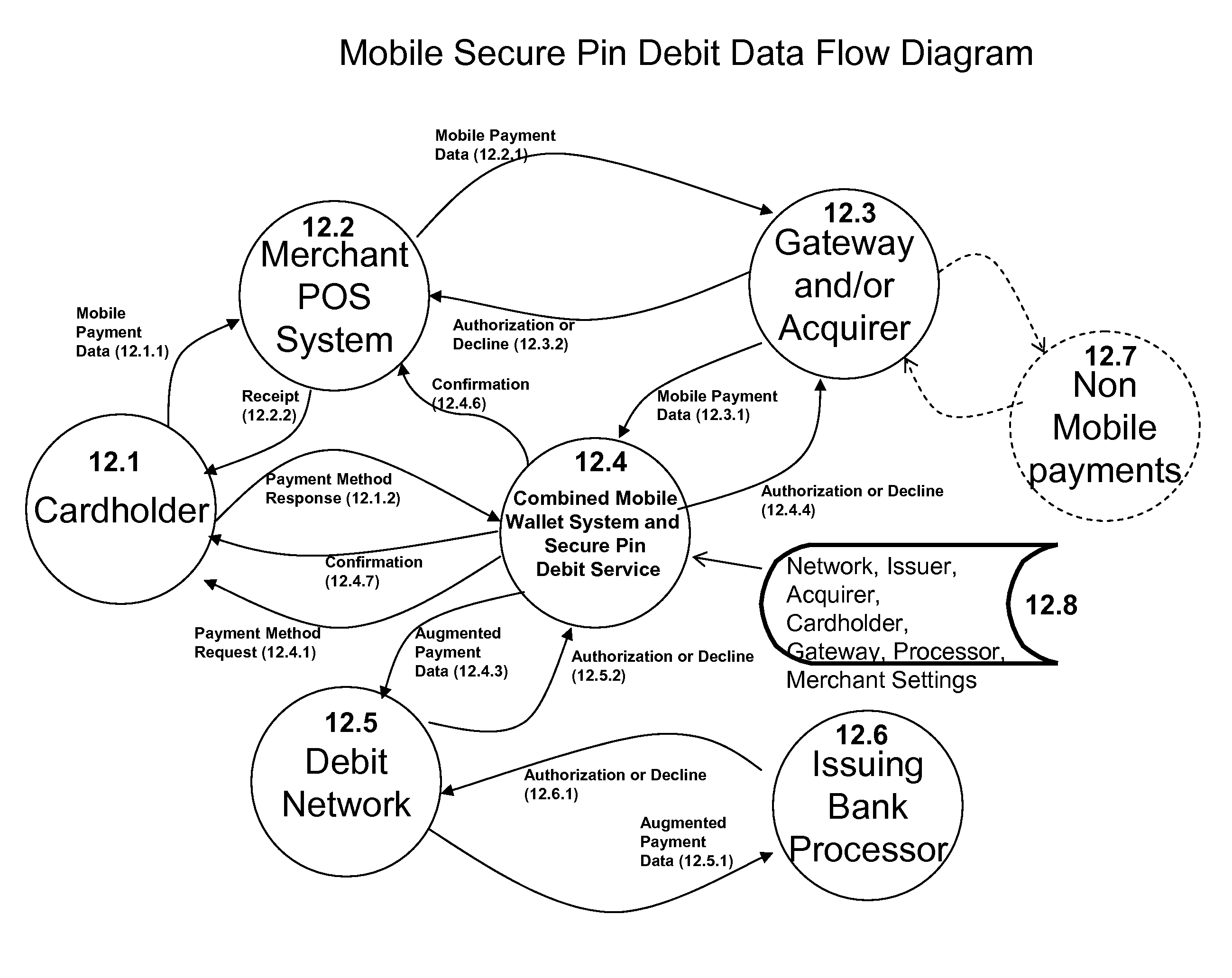

A method for facilitating the widespread use of the PIN-Debit payment method for Internet “eCommerce” and mobile payments sales which requires little or no change for the cardholders, merchants, debit networks and card issuers based primarily on the introduction of a layer of middleware and wherein the Debit Networks and Issuing Banks may customize the implementation of the services based on individual strategy and cardholder preferences.

Owner:STRIPE INC

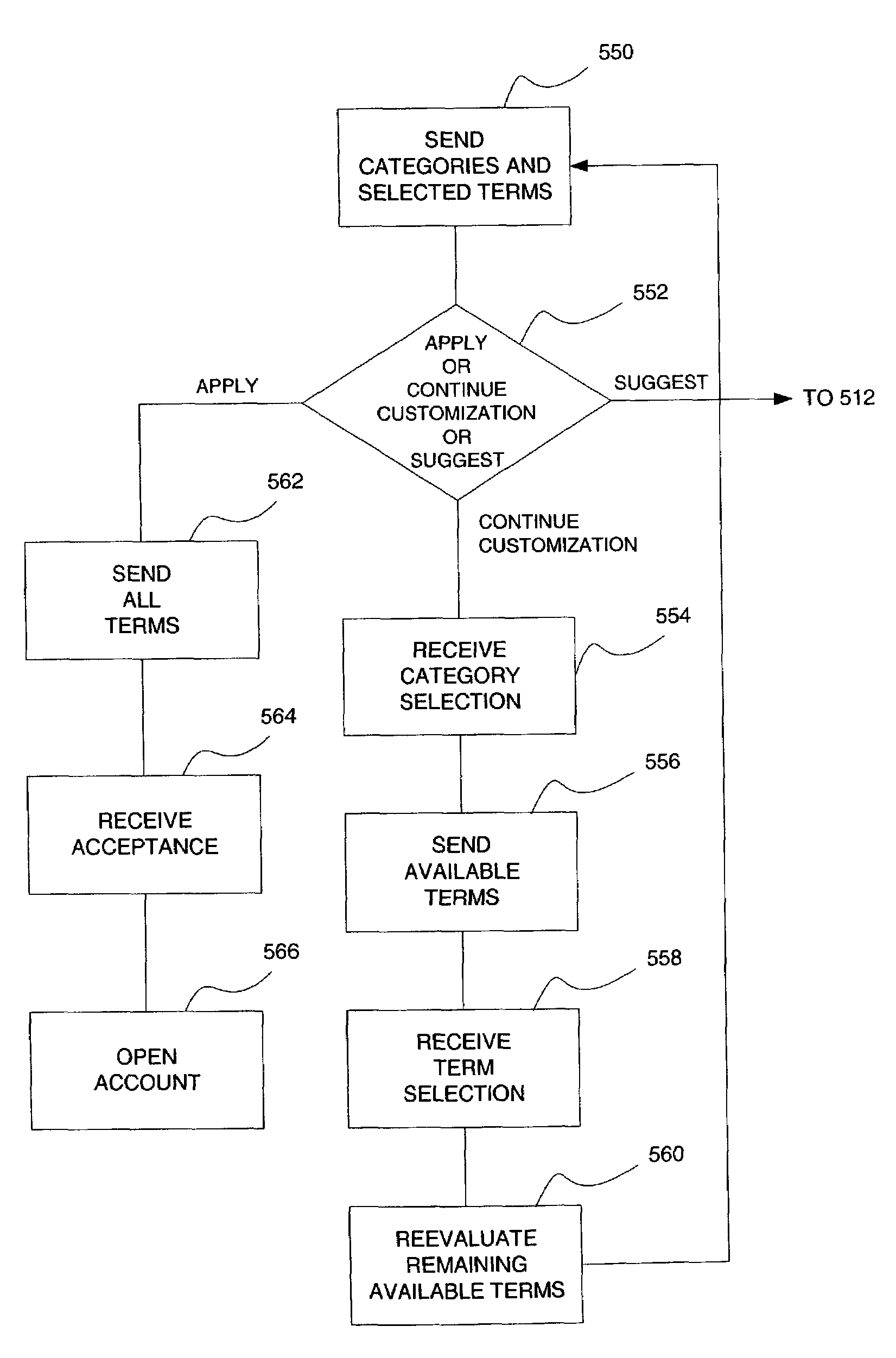

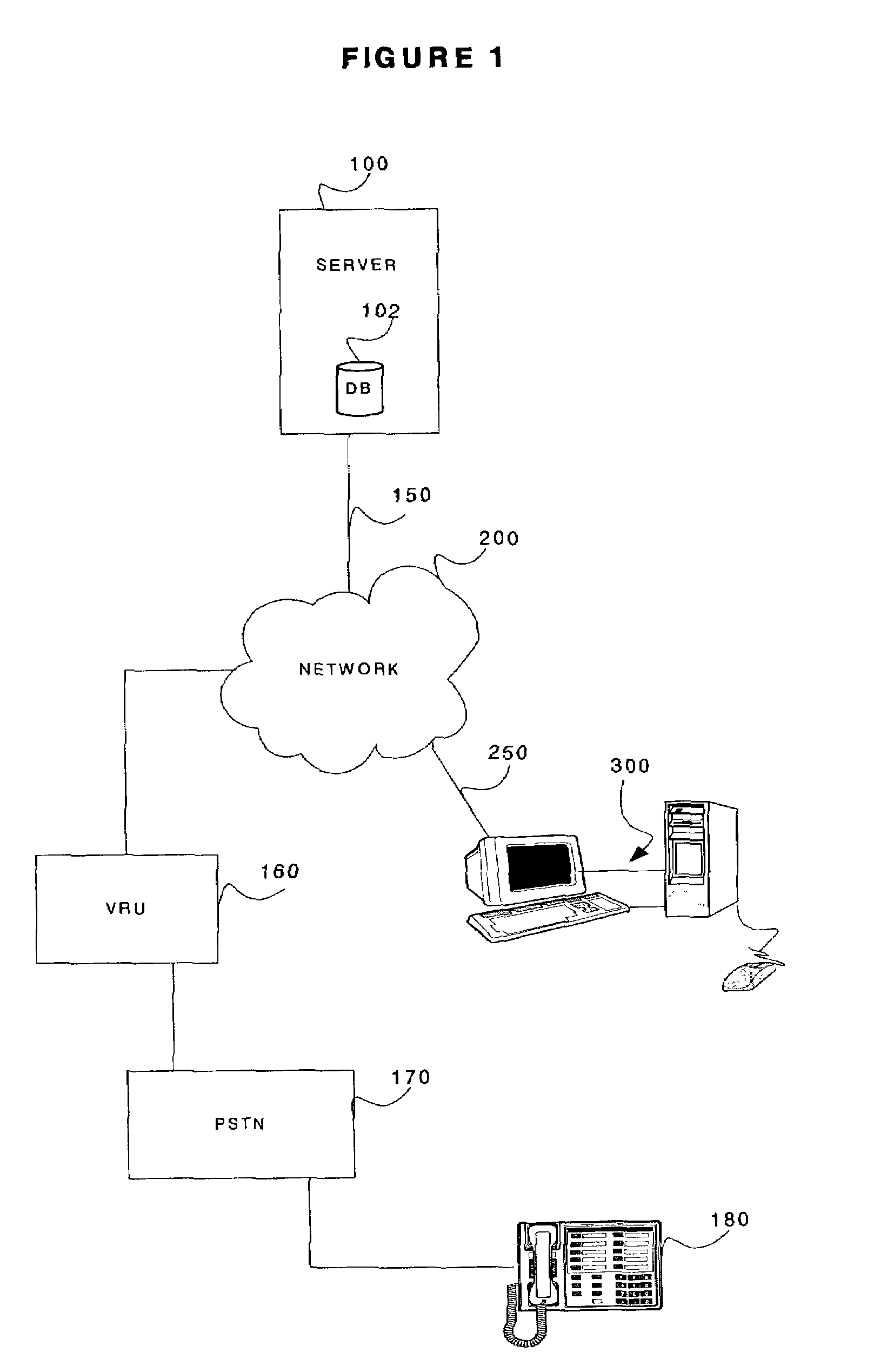

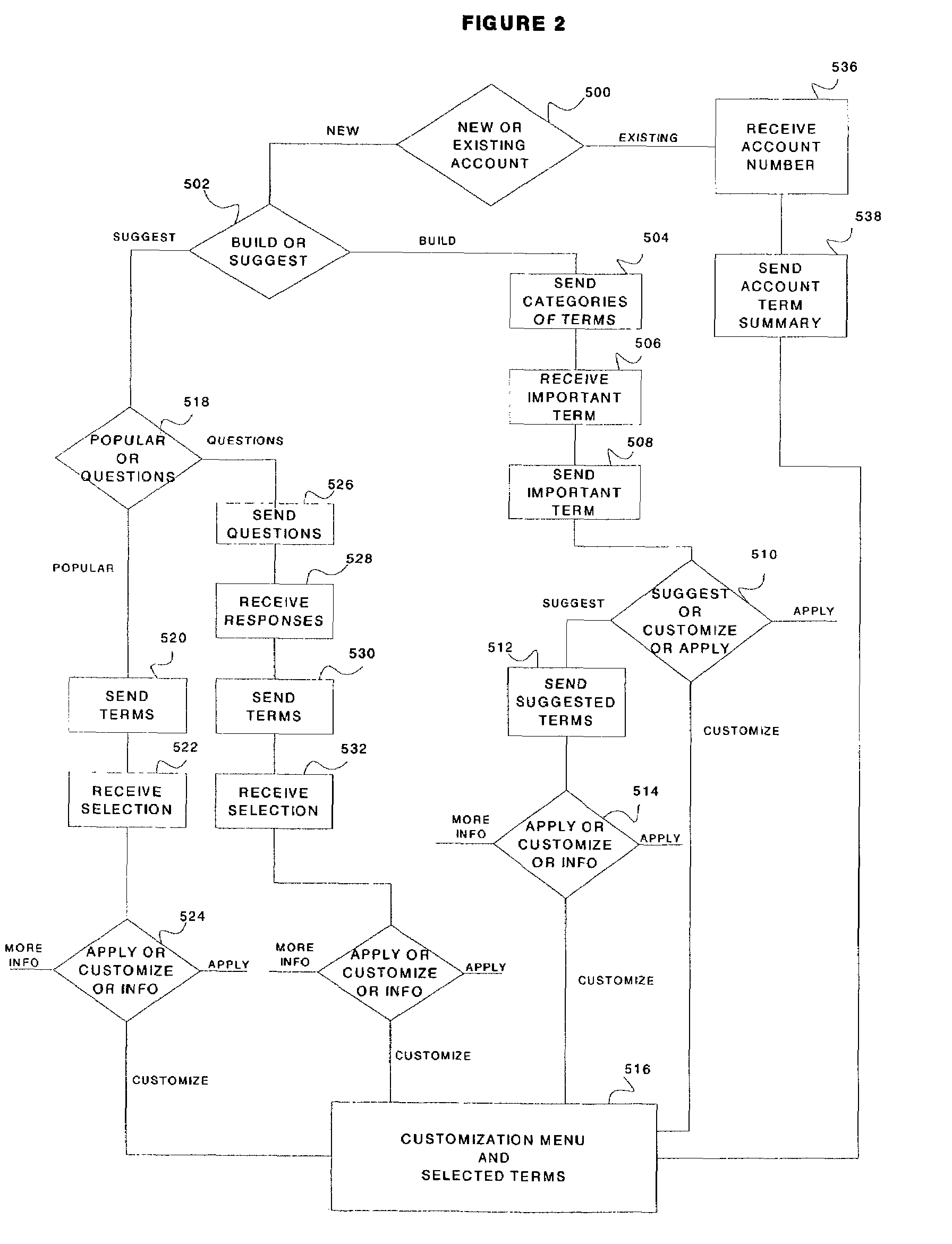

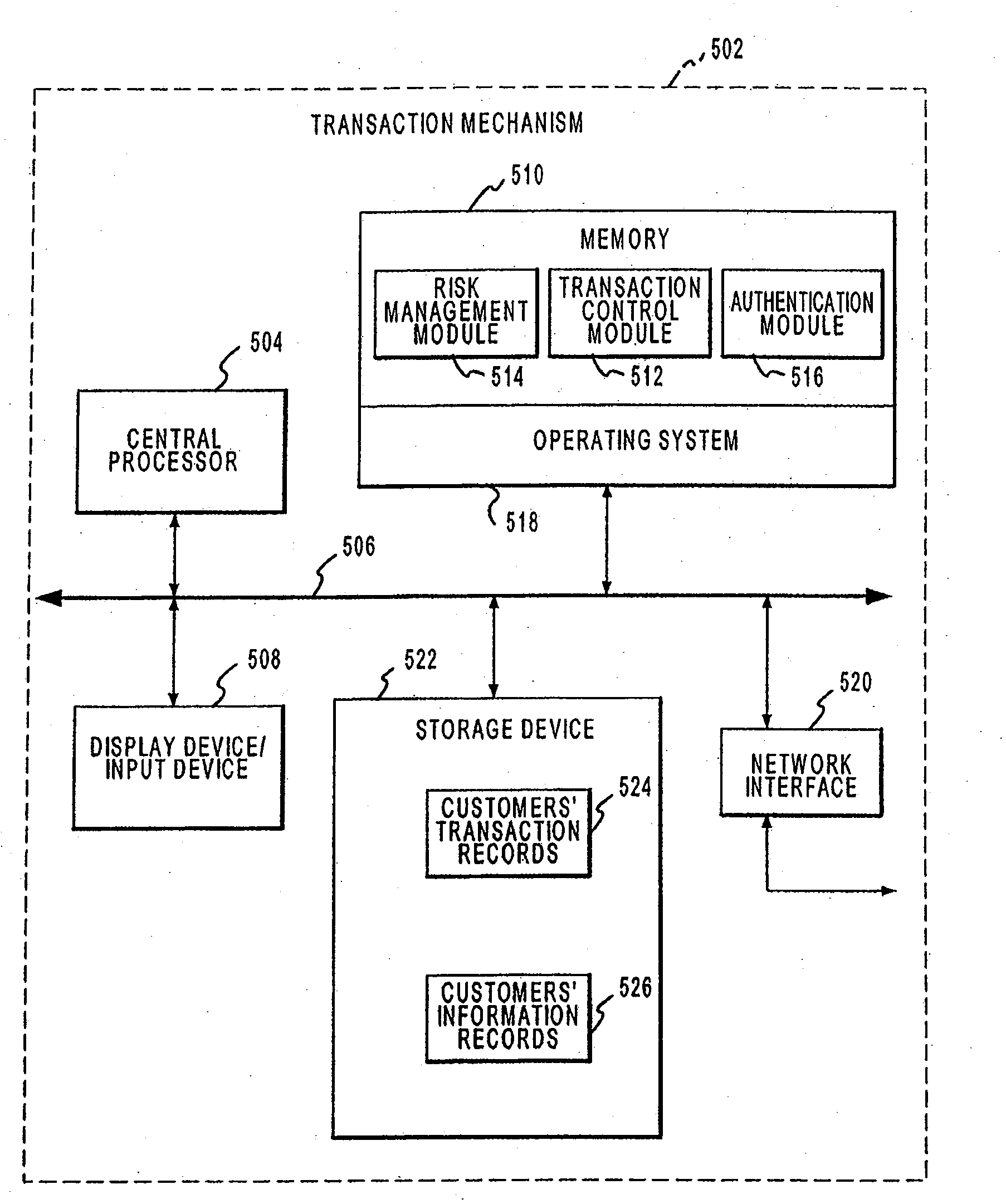

System and method for establishing or modifying an account with user selectable terms

ActiveUS7689504B2Easily customizedEasy to updateFinancePayment architectureIssuing bankService provision

The present invention relates to methods for allowing an account holder to easily customize the terms of an account such as a loan account, an asset account, a mortgage account, an insurance account, or a brokerage account. Exemplary embodiments of the invention allow the user to specify various preferred terms such as cost (e.g., APR and annual fee), rewards programs, card design, affiliates, credit line, and payment due date, among others. The financial service provider issuing the account, e.g., the issuing bank, may make the various available terms for the account easily accessible to the user, for example through an internet website or an automated phone system, enabling the user to easily specify his or her preferences. The customization methods may be applied to the process of opening a new account or customizing an existing account. The customization methods may dynamically update the available terms as the user begins to select his or her desired terms.

Owner:JPMORGAN CHASE BANK NA

Systems and Methods for Locating an Automated Clearing House Utilizing a Point of Sale Device

InactiveUS20090164325A1Easy to identifyEasy to calculateComplete banking machinesHand manipulated computer devicesThird partyIssuing bank

A point of sale (POS) device may be configured to locate a payment system and transmit a payment authorization request from a remote location to a payment system, either directly, or via a payment system directory and / or a SSL Gateway. The invention also includes inserting third party account information into an encrypted portion of the payment request, so the payment request appears as a normal request to the issuing bank, but the third party account information may be used by the third party to bill the customer. The payment system directory is further configured to determine one or more payment processors to direct a payment authorization request, such that a single transaction may me allocated among multiple payment processors for authorization. Moreover, the payment system directory is able to format alternative payment methods into a format that is able to be processed over existing payment networks.

Owner:LIBERTY PEAK VENTURES LLC +1

Systems and Methods for Processing a Payment Authorization Request Over Disparate Payment Networks

InactiveUS20090164330A1Easy to identifyEasy to calculateHand manipulated computer devicesFinanceThird partyIssuing bank

A point of sale (POS) device may be configured to locate a payment system and transmit a payment authorization request from a remote location to a payment system, either directly, or via a payment system directory and / or a SSL Gateway. The invention also includes inserting third party account information into an encrypted portion of the payment request, so the payment request appears as a normal request to the issuing bank, but the third party account information may be used by the third party to bill the customer. The payment system directory is further configured to determine one or more payment processors to direct a payment authorization request, such that a single transaction may me allocated among multiple payment processors for authorization. Moreover, the payment system directory is able to format alternative payment methods into a format that is able to be processed over existing payment networks.

Owner:LIBERTY PEAK VENTURES LLC

Method and system for issuing, aggregating and redeeming rewards based on merchant transactions

A loyalty or reward point system that utilizes the pre-existing infrastructure of a typical credit card network. In one embodiment, a user makes a purchase at a merchant of a product using a credit card. The merchant contacts the acquiring bank (which may be any type of financial institution but is referred to generically herein as a bank) with which it has contracted for credit card network services, and as known in the art, will get an approval or decline message after the acquiring bank contacts the issuing bank of the credit card used by the purchaser. Assuming that the purchase transaction is approved, the user is awarded loyalty points from the merchant based on the amount of the purchase (e.g. 100 points for a $100 purchase). A central server resides on the credit card network and tracks the transaction between the merchant, the acquiring bank, and the issuing bank. A reward account is maintained on the central server on behalf of the merchant and the user, and the number of reward points in the user's account for that merchant is increased accordingly. In an alternative embodiment, the user's reward points are logged in an account maintained by the acquiring bank on behalf of the merchant (with which it has a contractual relationship) and the user. The user may redeem the reward points earned from the transaction with the merchant at a later time, or may redeem the points with another merchant on the credit card network, or may aggregate those reward points with those of other merchants into a central exchange account, and then redeem the aggregated points for goods or services from any approved merchant on the network, depending on the configuration of the system.

Owner:SIGNATURE SYST

Systems and Methods for Locating a Payment System and Determining a Taxing Authority Utilizing a Point of Sale Device

InactiveUS20090164328A1Easy to identifyEasy to calculatePayment circuitsPoint-of-sale network systemsIssuing bankThird party

A point of sale (POS) device may be configured to locate a payment system and transmit a payment authorization request from a remote location to a payment system, either directly, or via a payment system directory and / or a SSL Gateway. The invention also includes inserting third party account information into an encrypted portion of the payment request, so the payment request appears as a normal request to the issuing bank, but the third party account information may be used by the third party to bill the customer. The payment system directory is further configured to determine one or more payment processors to direct a payment authorization request, such that a single transaction may me allocated among multiple payment processors for authorization. Moreover, the payment system directory is able to format alternative payment methods into a format that is able to be processed over existing payment networks.

Owner:LIBERTY PEAK VENTURES LLC +1

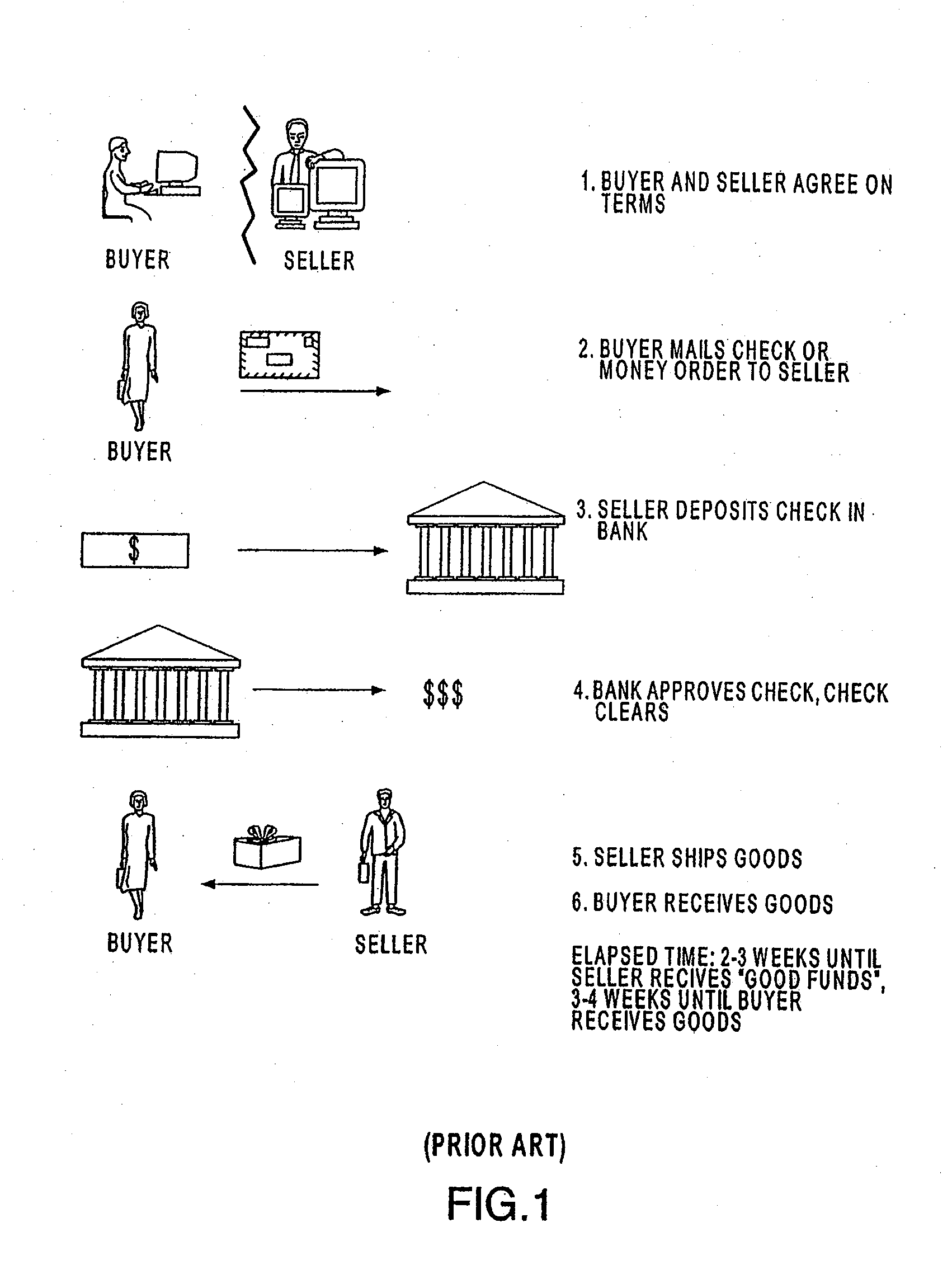

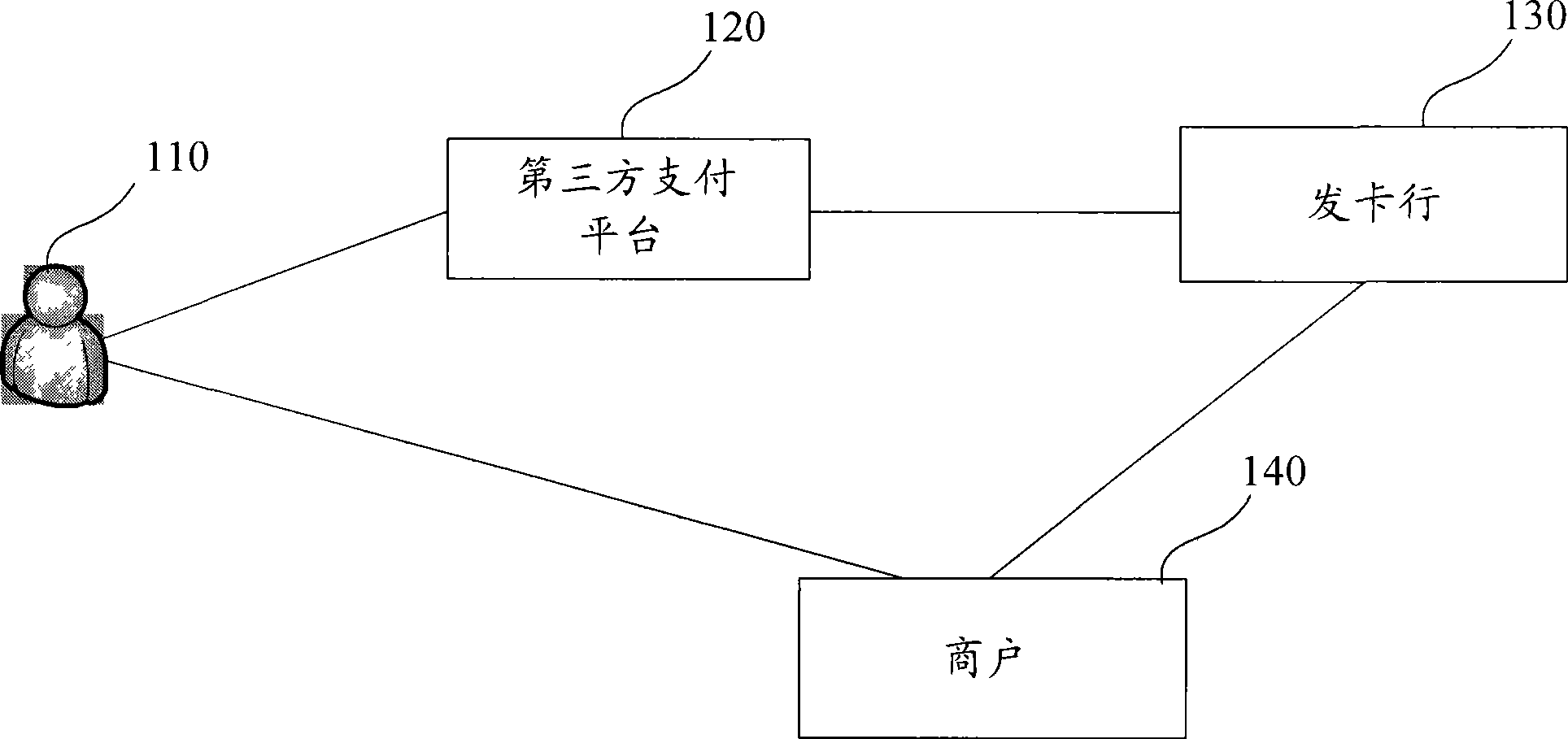

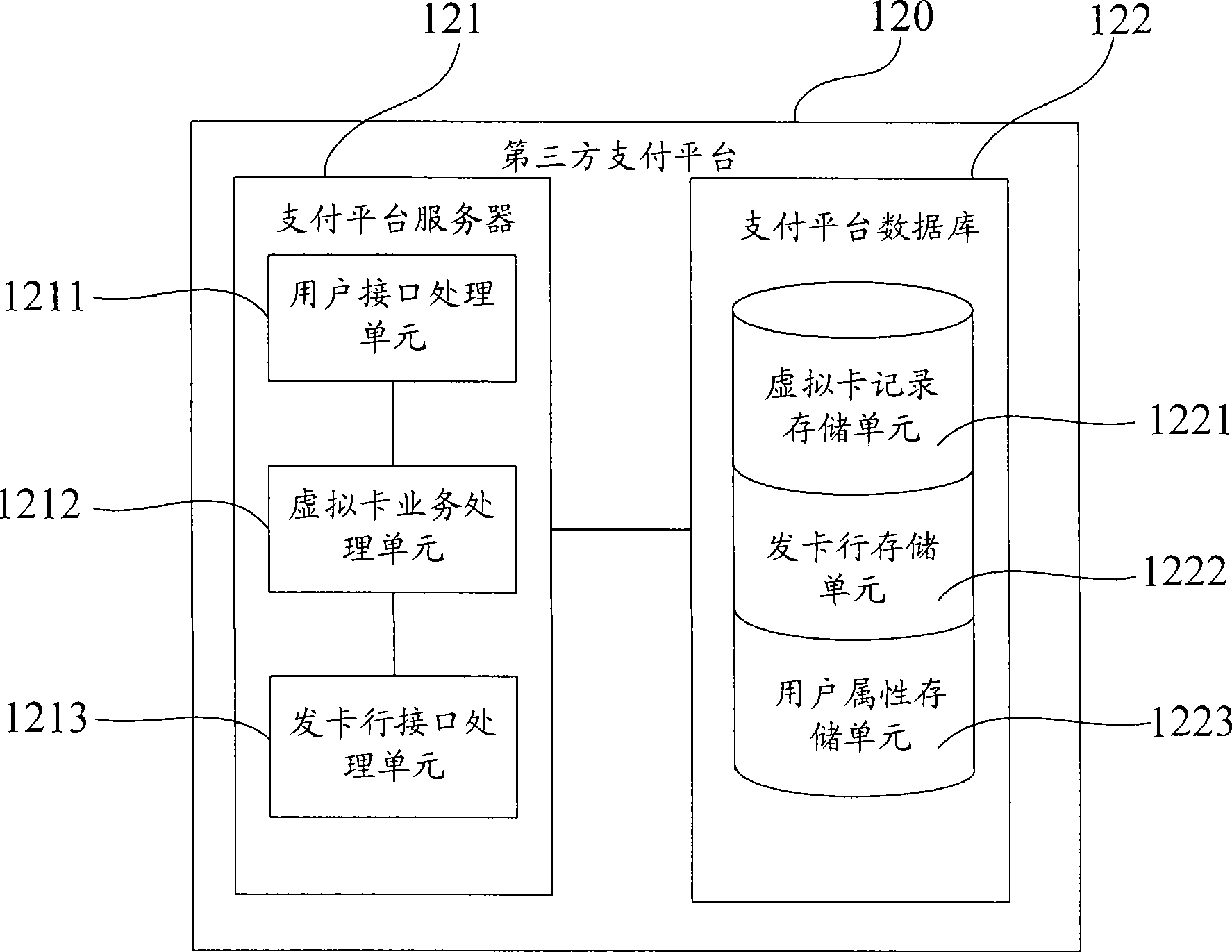

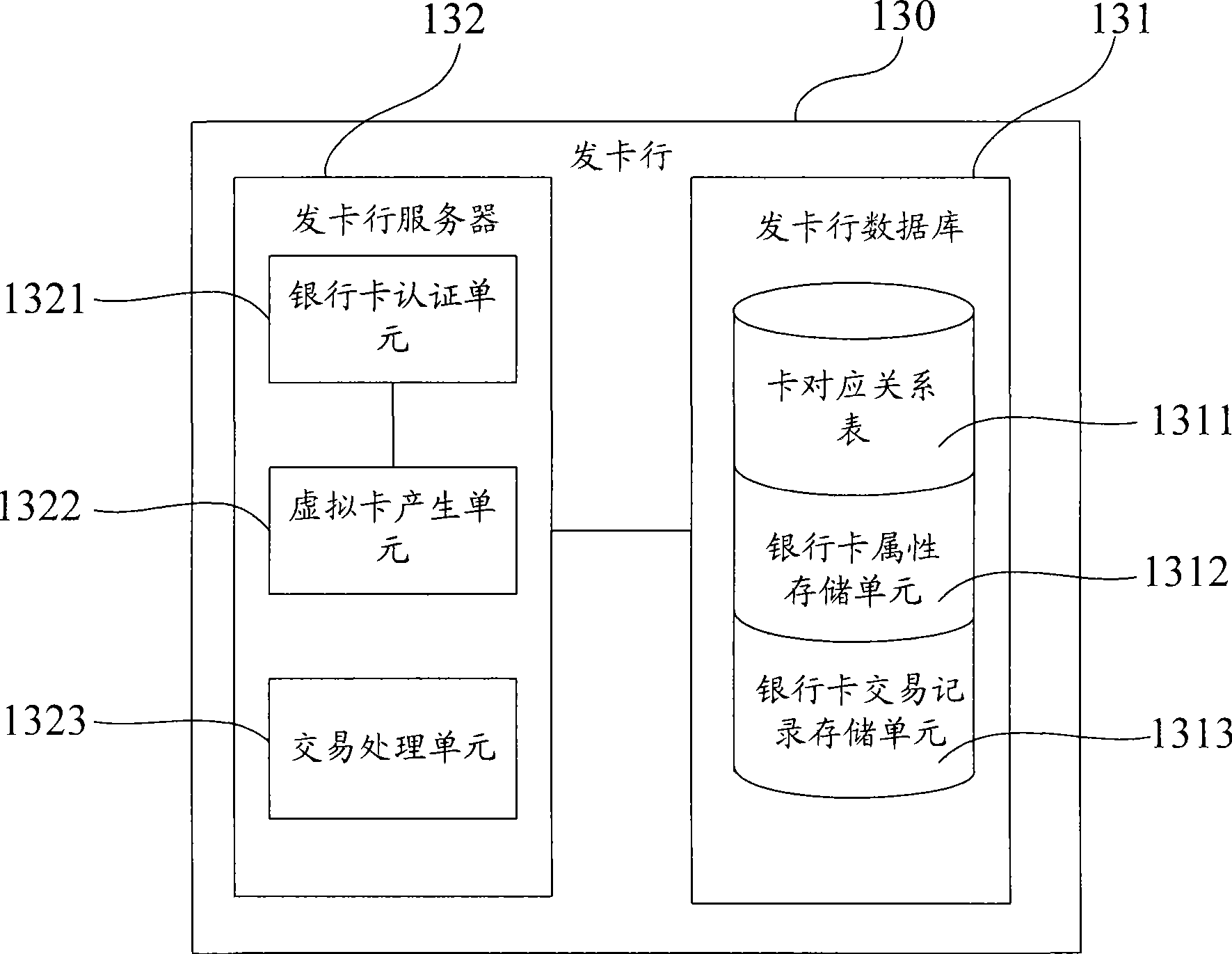

Payment method, system and payment platform capable of improving payment safety by virtual card

The invention provides a method of payment utilizing a virtual card to enhance payment safety and a system thereof, wherein, the method of payment includes the following steps : a third-party payment platform is provided; after receiving the application request of virtual card of a user, the third-party payment platform obtains the information of bank card of the user and sends the request of virtual card application to a corresponding issuing bank; the third-party payment platform returns the information of virtual card number sent by the issuing bank to the user; and when the issuing bank receives the request of payment including the information of virtual card number and payment amount, payment is successfully done, provided that the virtual card meets the service regulations of the virtual card and monetary amount on the corresponding bank card is no less than the payment amount. As the payment of the invention is carried out by the virtual card number, information security of the card can be enhanced when the bank card number and password are directly input.

Owner:ALIBABA GRP HLDG LTD

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com