Patents

Literature

434 results about "Personal account" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

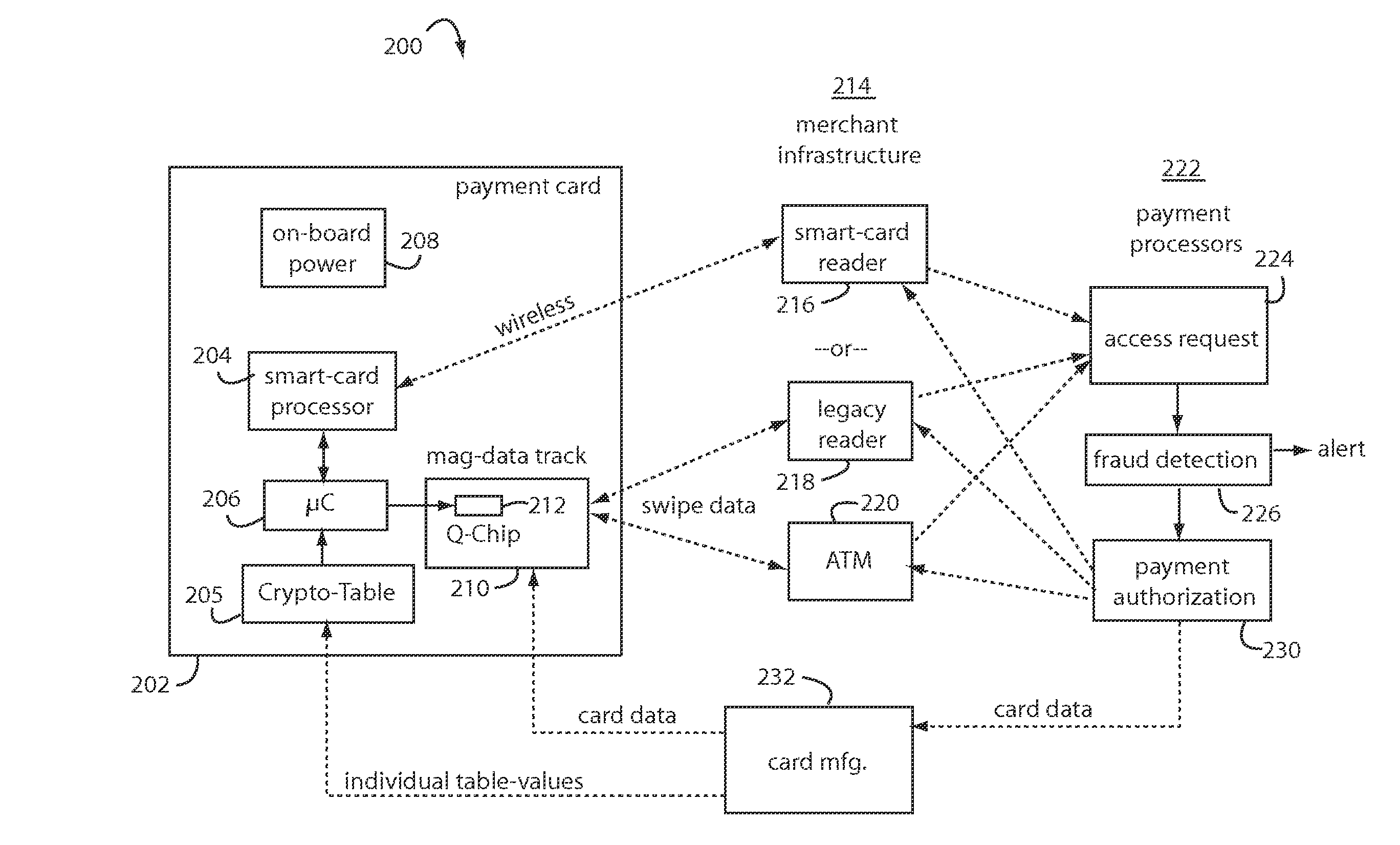

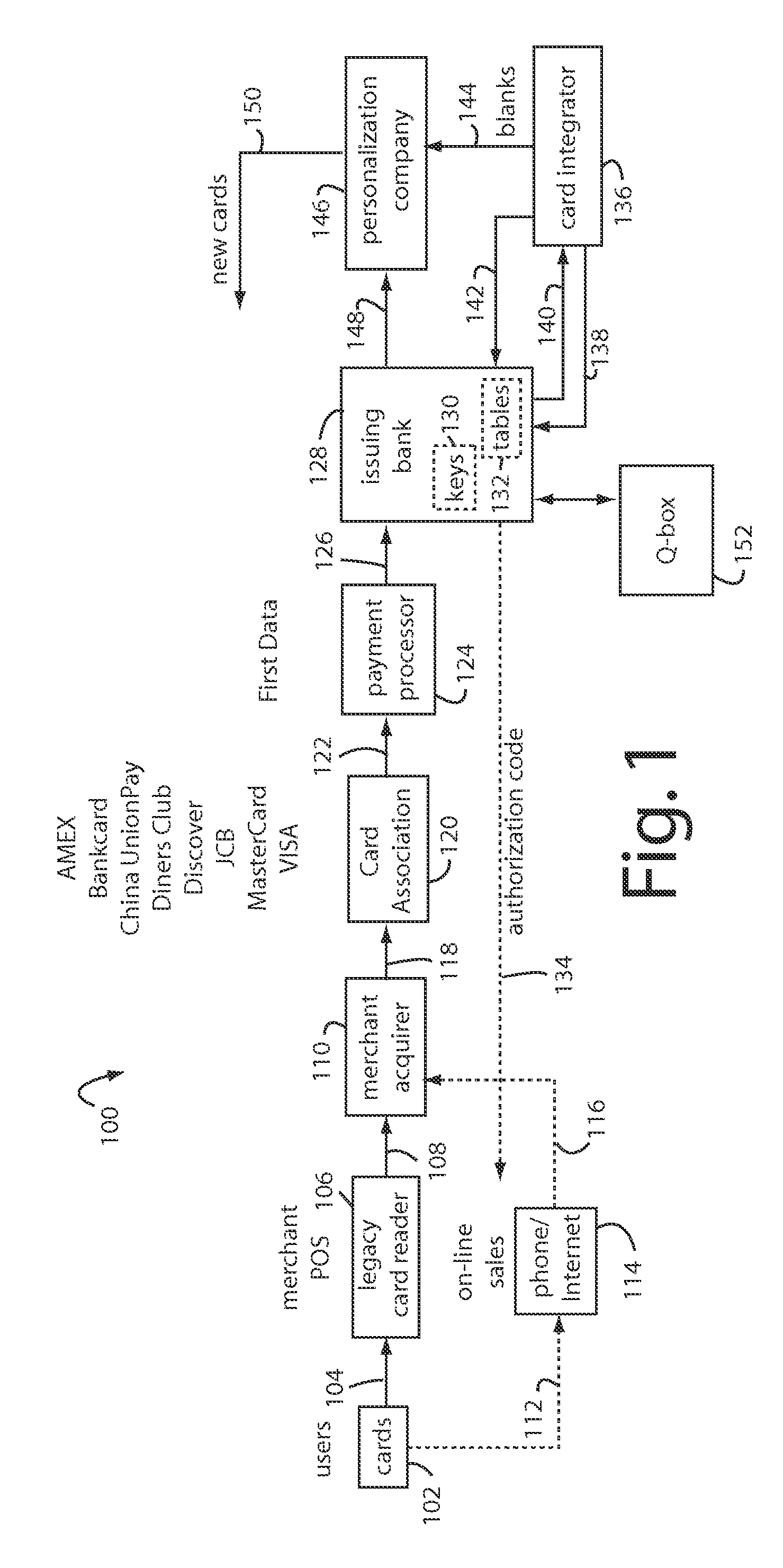

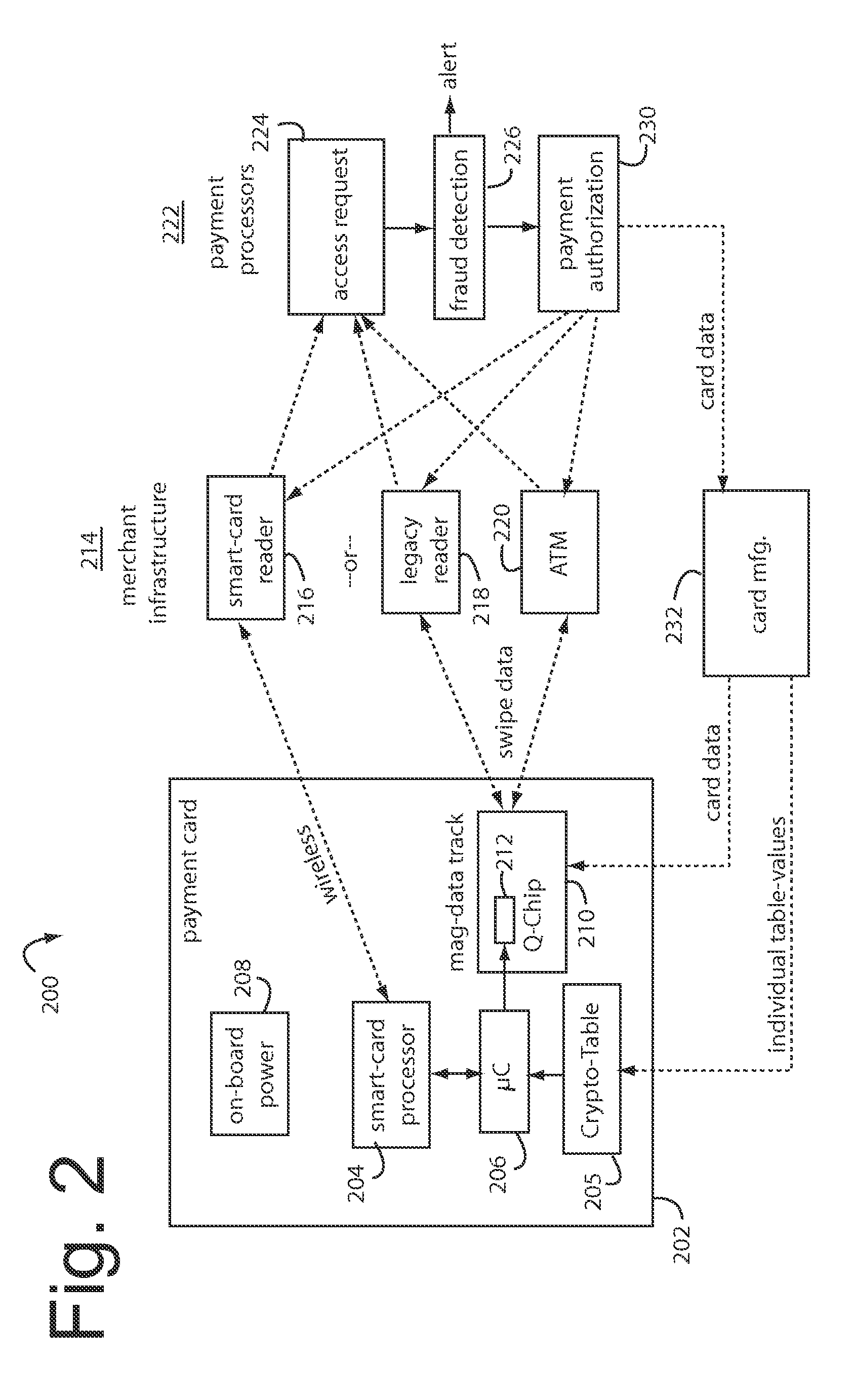

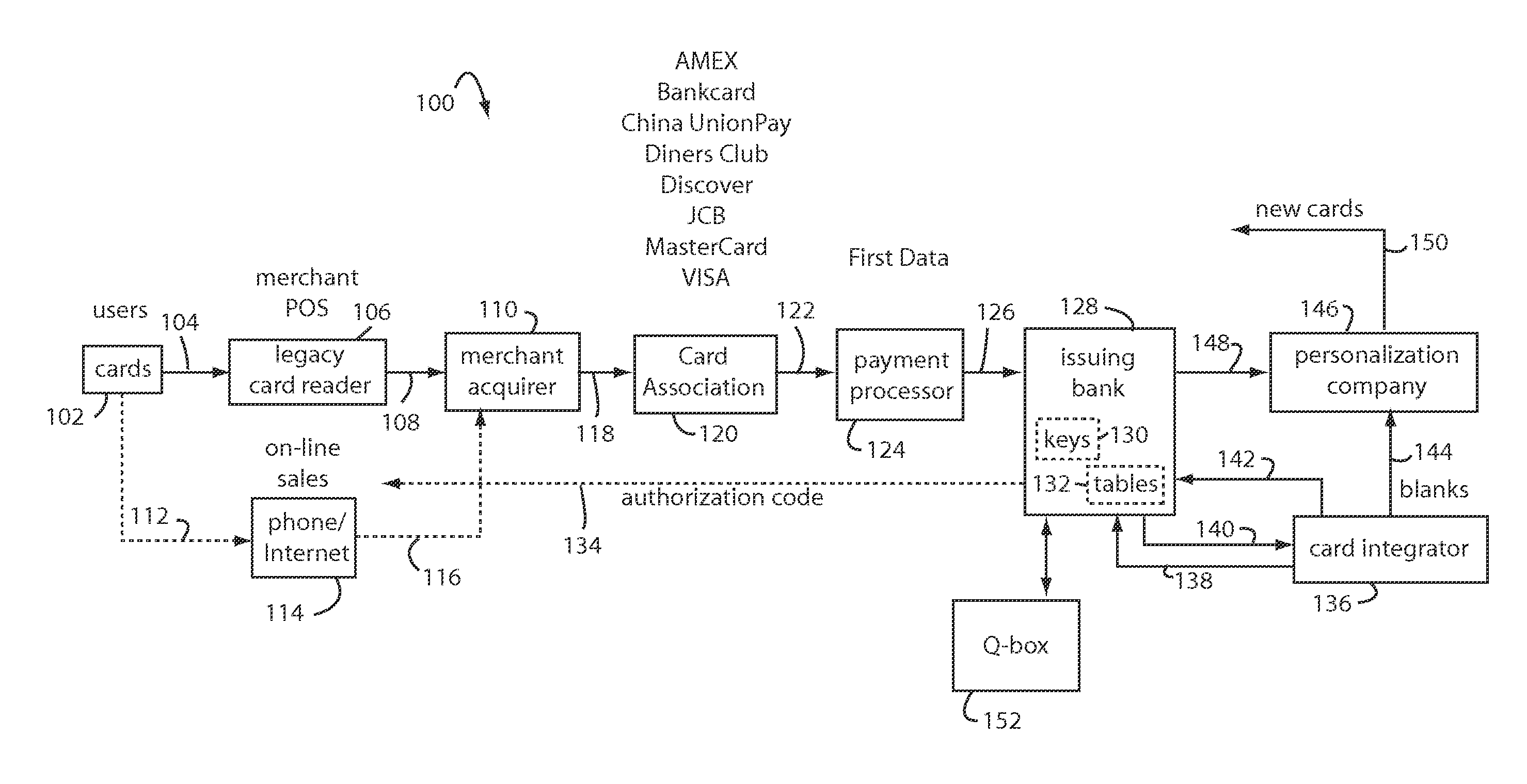

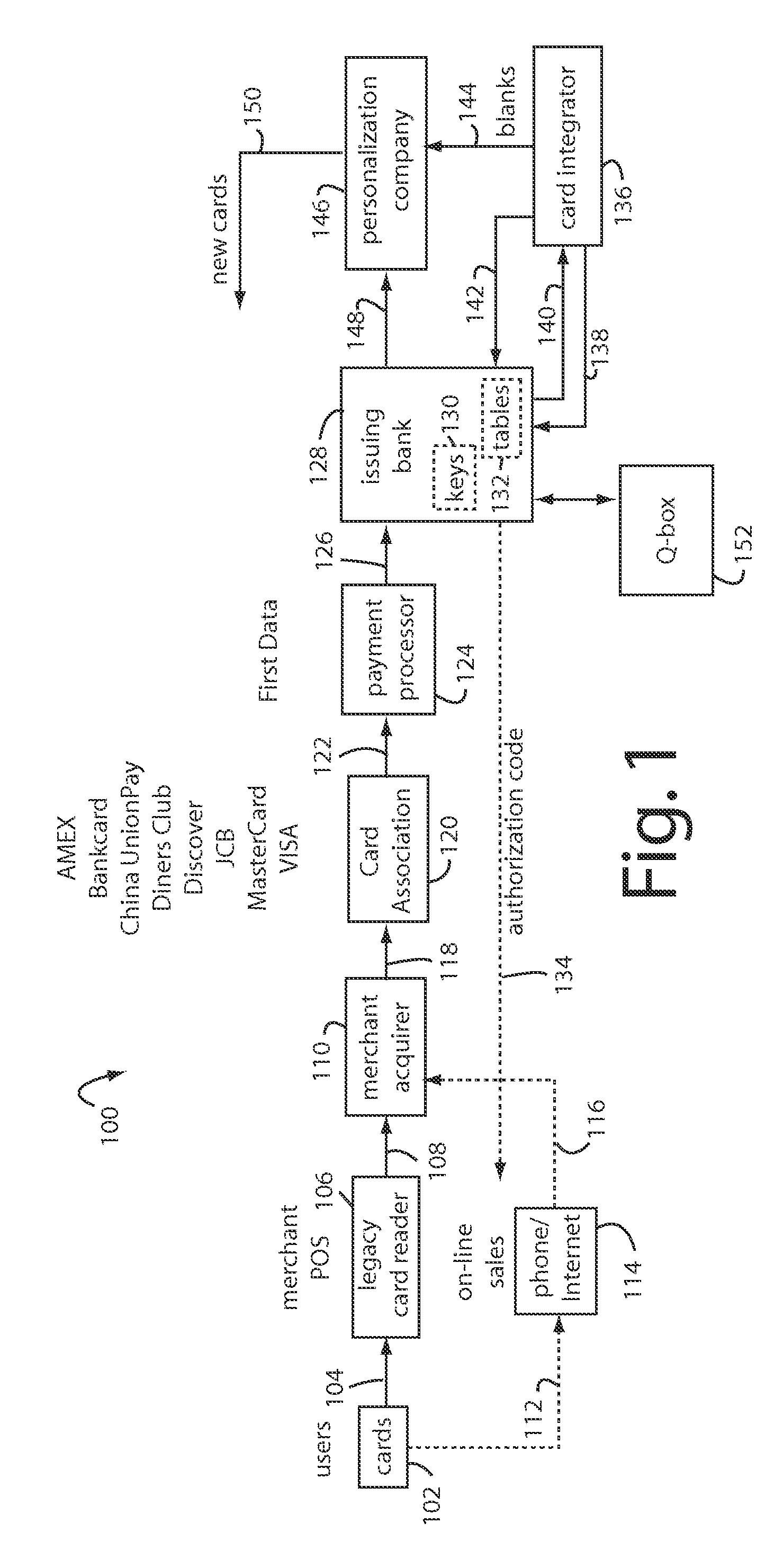

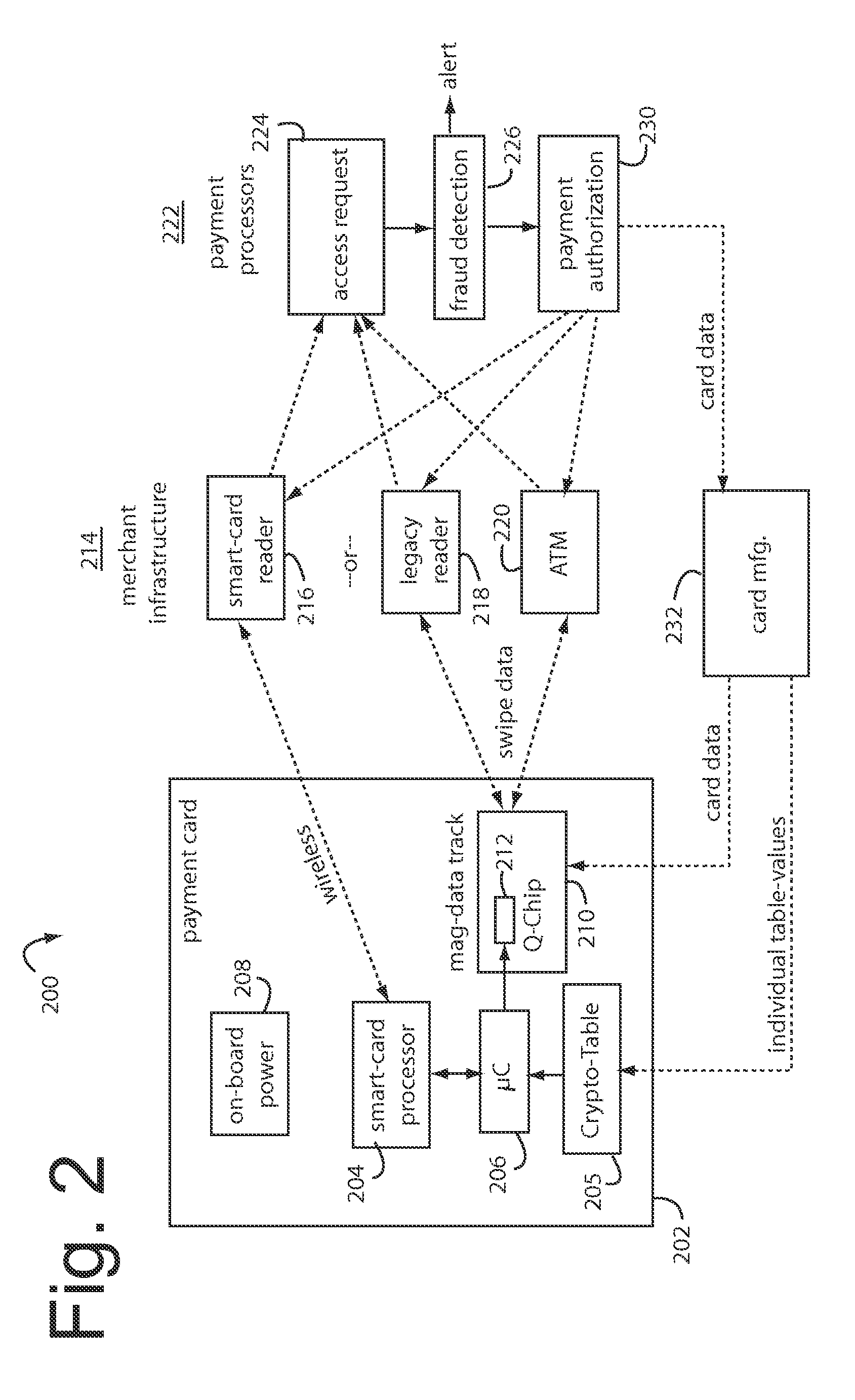

Financial transactions with dynamic personal account numbers

ActiveUS7580898B2Sufficient dataComputer security arrangementsPayment architecturePersonalizationIssuing bank

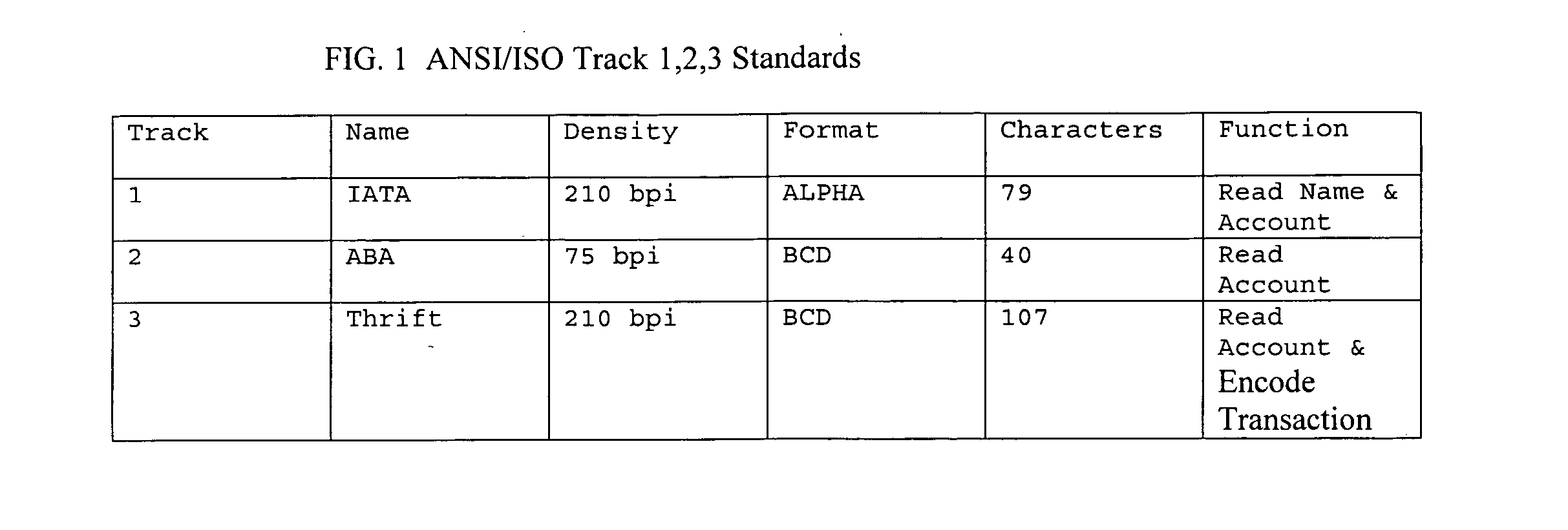

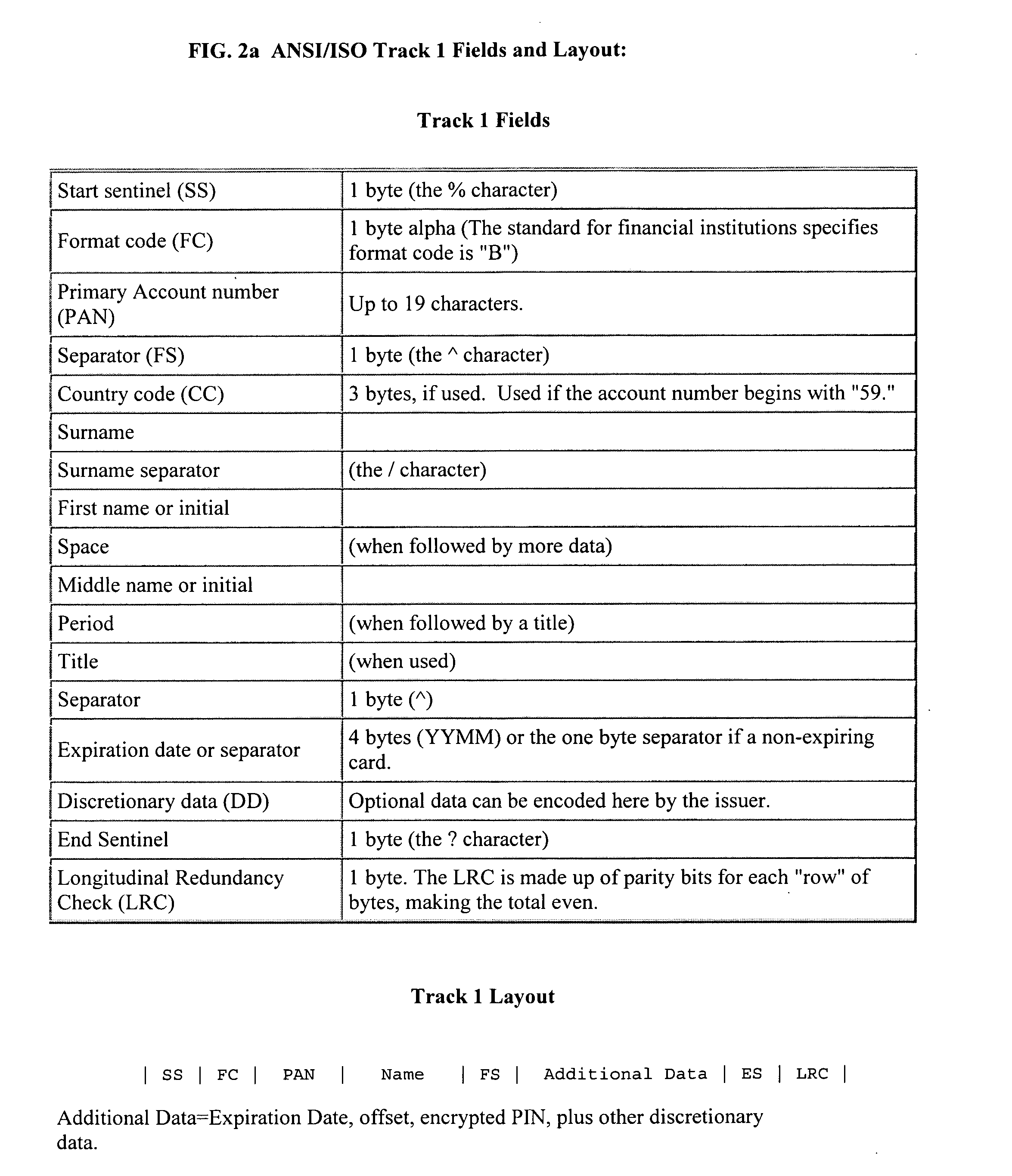

A method for securing financial transactions involving payment cards includes associating a sixteen-digit personal account number (PAN) with a particular payment card and user, wherein are included fields for a system number, a bank / product number, a user account number, and a check digit. A four-digit expiration date (MMYY) associated with the PAN. A magnetic stripe on the payment card is encoded with the PAN for periodic reading by a magnetic card reader during a financial transaction. A table of cryptographic values associated with the PAN and the MMYY is stored on each user's payment card during personalization by an issuing bank. A next financial transaction being commenced with the payment card is sensed. A cryptographic value from the table of cryptographic values is selected for inclusion as a dynamic portion of the user account number with the PAN when a next financial transaction is sensed. Any cryptographic value from the table of cryptographic values will not be used again in another financial transaction after being used once. The issuing bank authorizes the next financial transaction only if the PAN includes a correct cryptographic value in the user account number field.

Owner:FITBIT INC

Financial transactions with dynamic personal account numbers

ActiveUS20070208671A1Sufficient dataComputer security arrangementsPayment architecturePersonalizationIssuing bank

A method for securing financial transactions involving payment cards includes associating a sixteen-digit personal account number (PAN) with a particular payment card and user, wherein are included fields for a system number, a bank / product number, a user account number, and a check digit. A four-digit expiration date (MMYY) associated with the PAN. A magnetic stripe on the payment card is encoded with the PAN for periodic reading by a magnetic card reader during a financial transaction. A table of cryptographic values associated with the PAN and the MMYY is stored on each user's payment card during personalization by an issuing bank. A next financial transaction being commenced with the payment card is sensed. A cryptographic value from the table of cryptographic values is selected for inclusion as a dynamic portion of the user account number with the PAN when a next financial transaction is sensed. Any cryptographic value from the table of cryptographic values will not be used again in another financial transaction after being used once. The issuing bank authorizes the next financial transaction only if the PAN includes a correct cryptographic value in the user account number field.

Owner:FITBIT INC

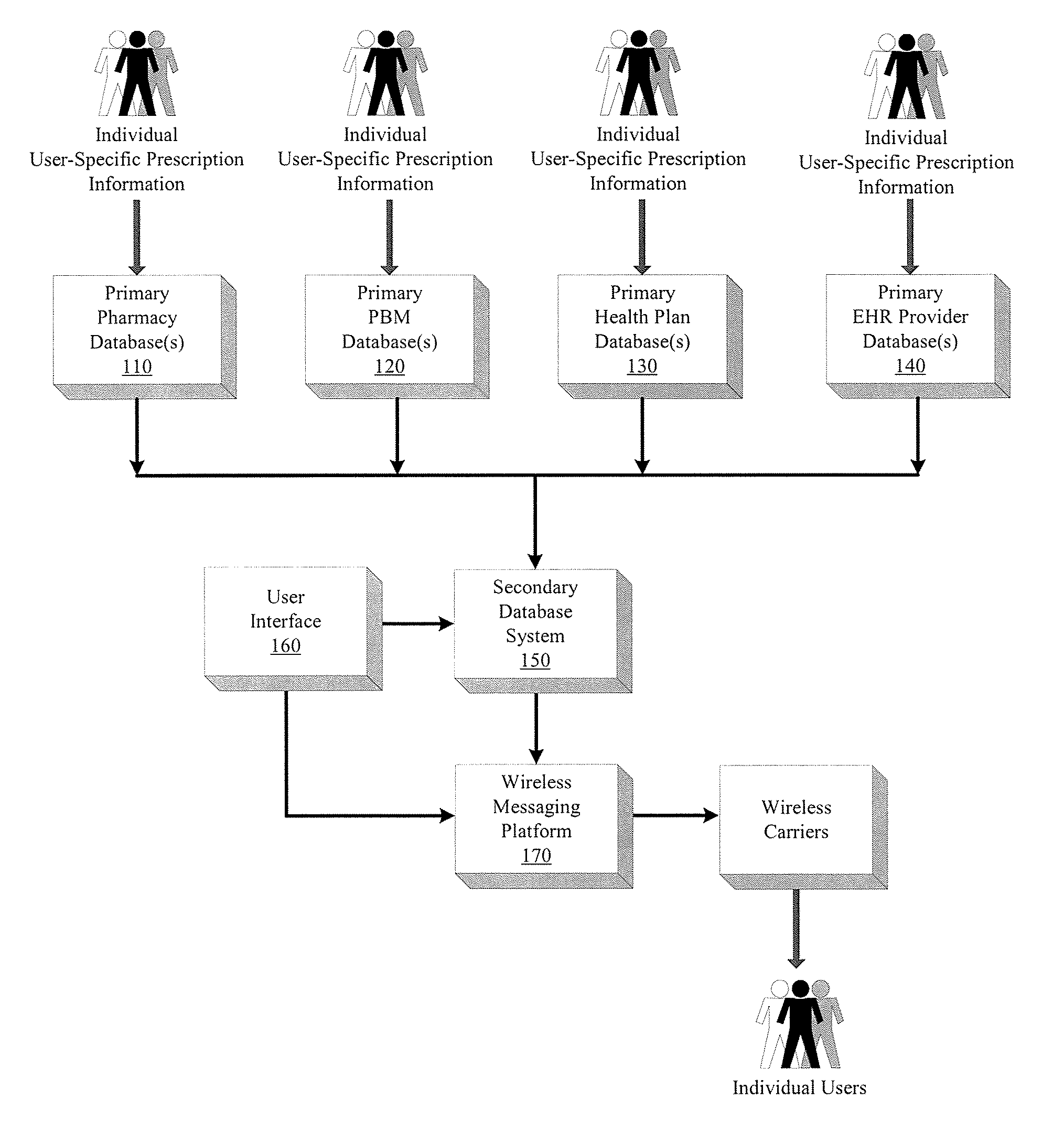

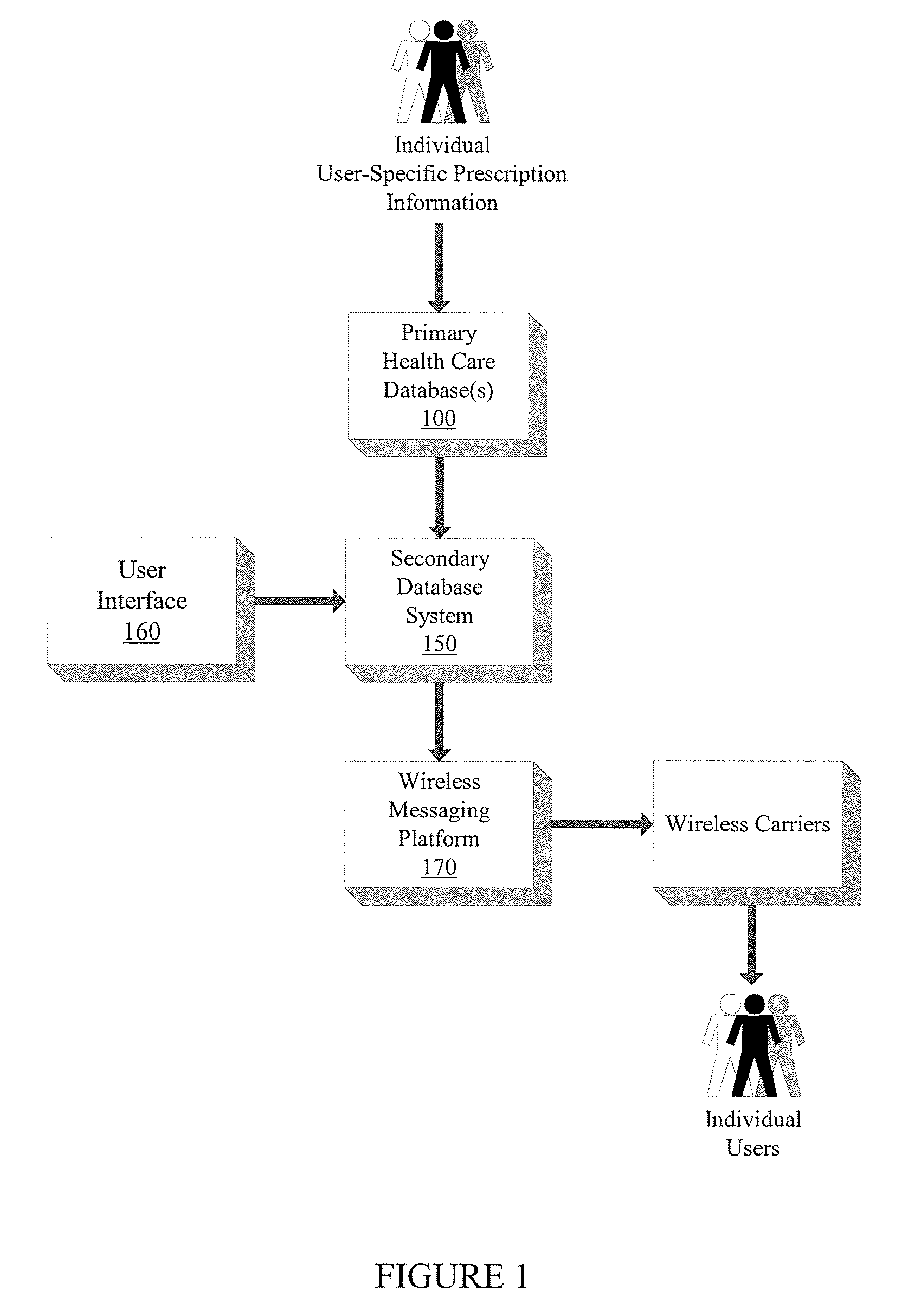

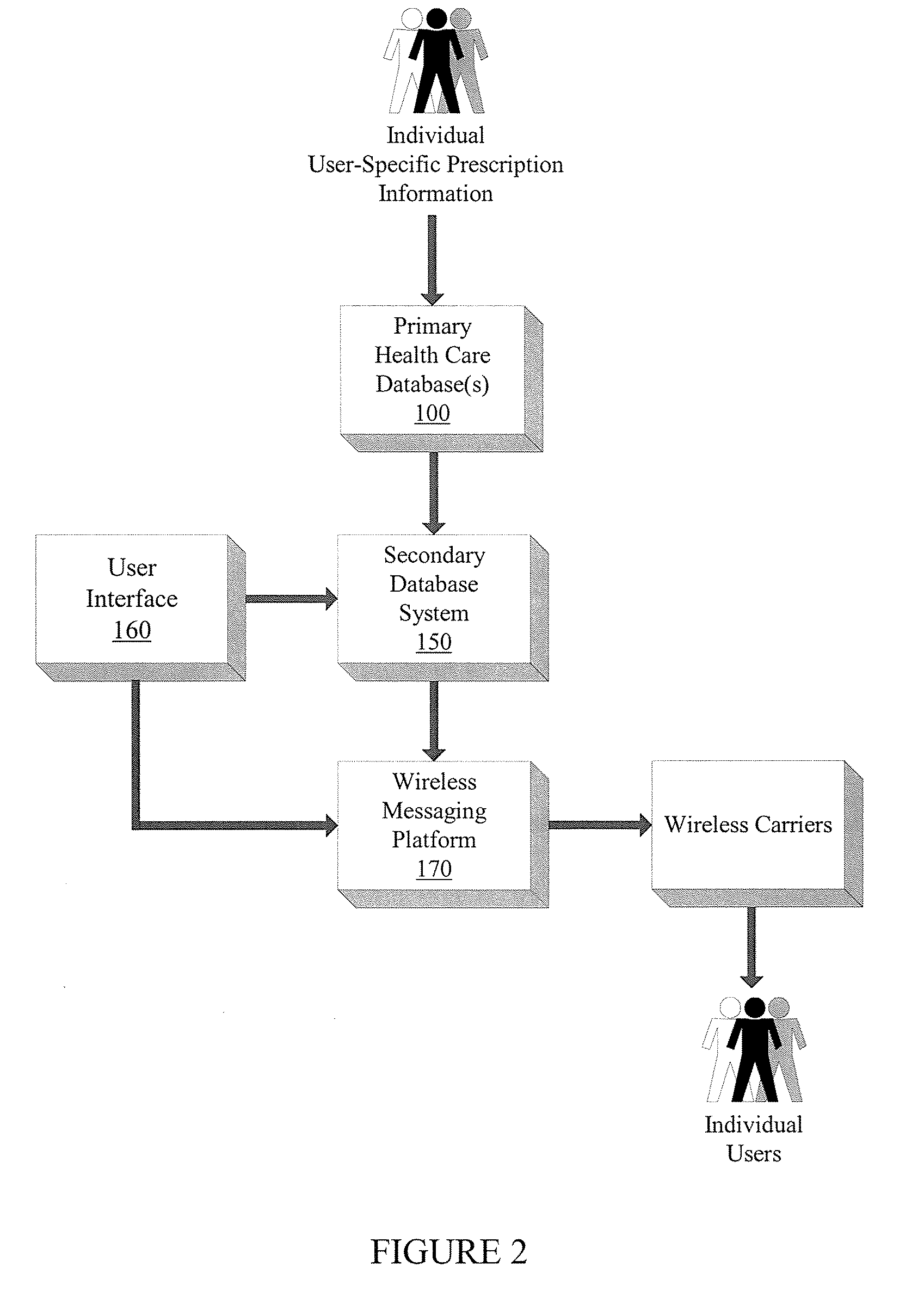

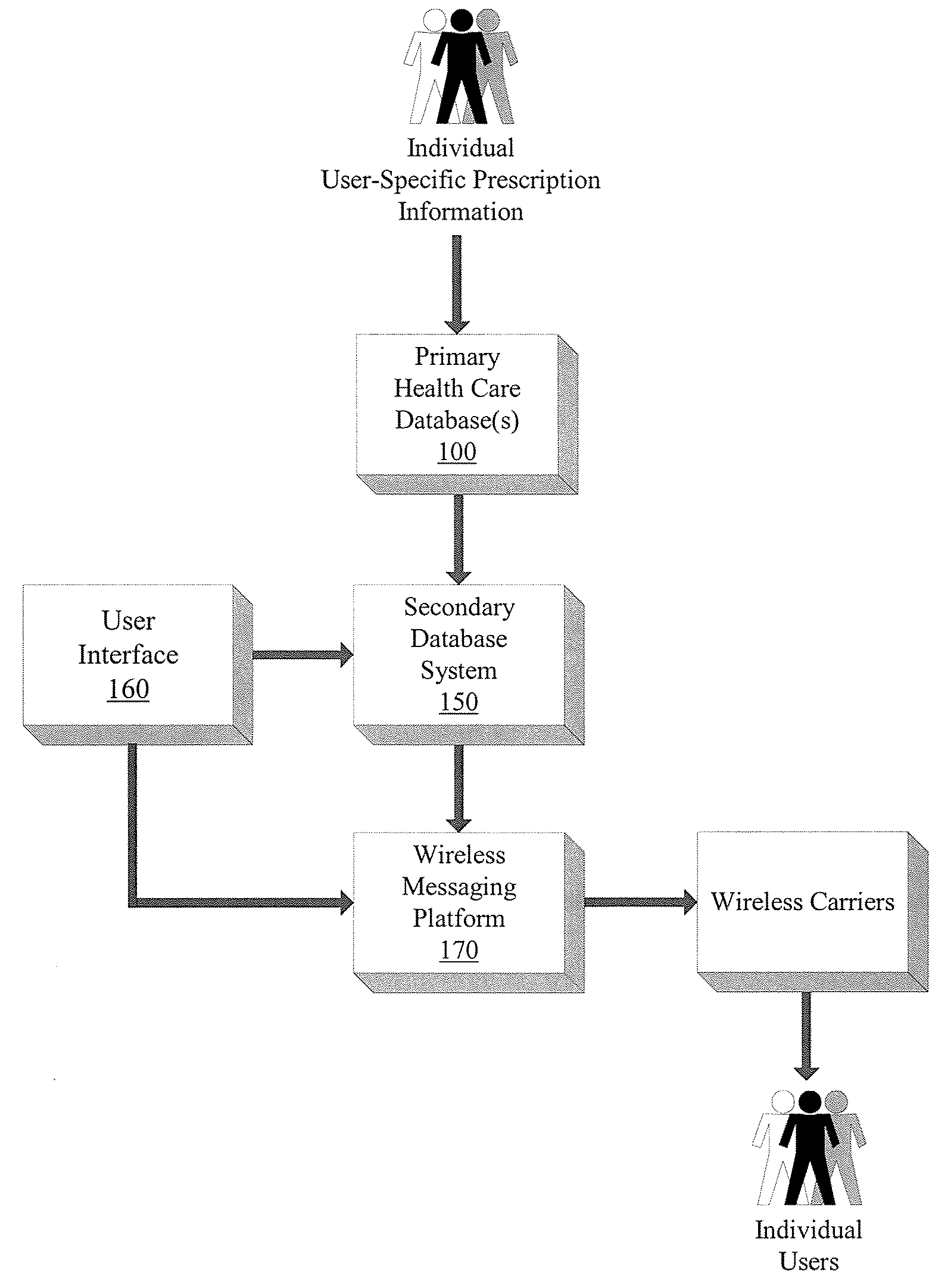

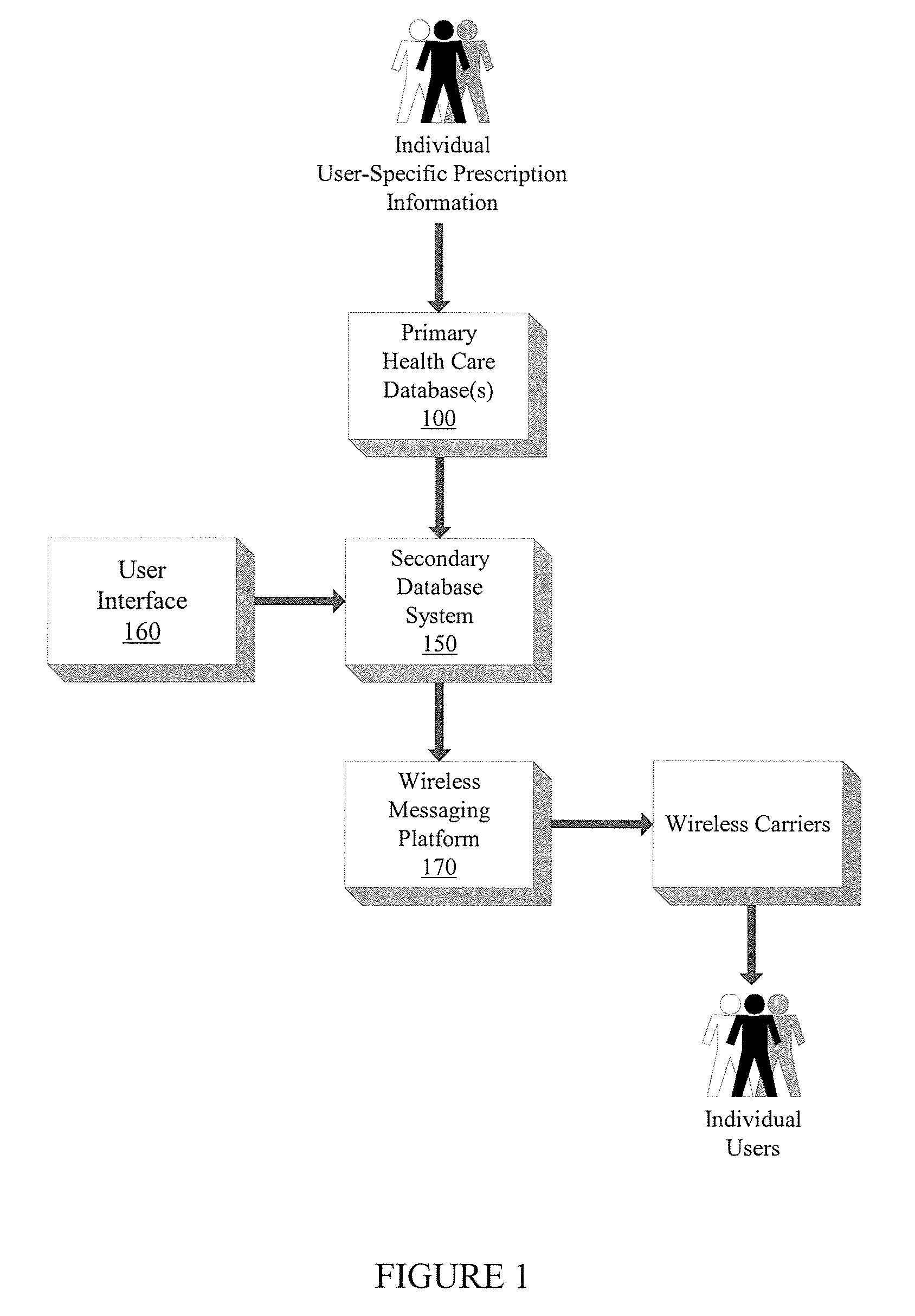

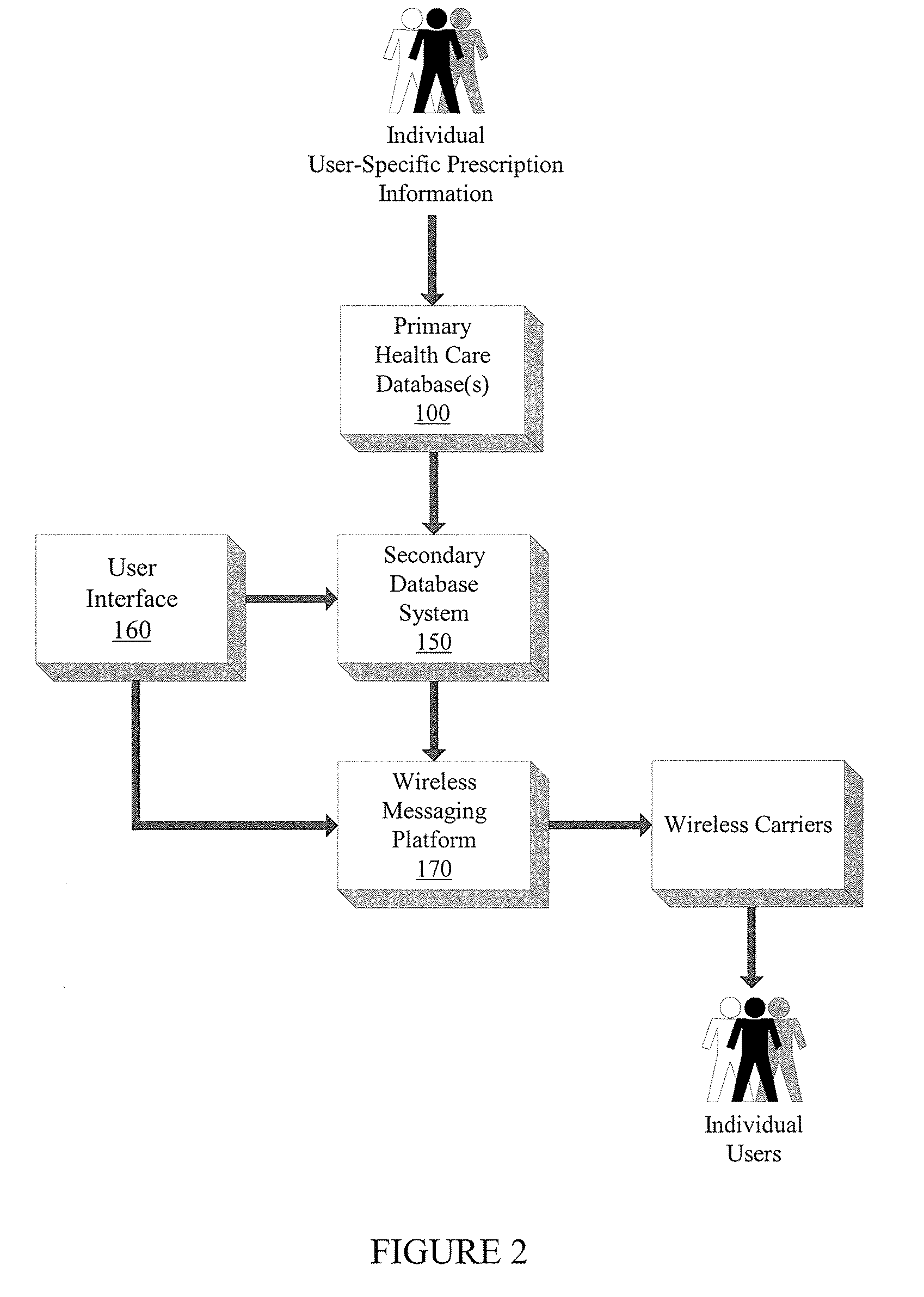

Integrated prescription management and compliance system

A system and method for prescription therapy management and compliance are provided. The system framework integrates primary databases from pharmacies, pharmacy benefit managers (PBMs), health plans, and EHR providers with a secondary database system, user interface, and wireless messaging platform, in order to extract and aggregate user-specific prescription data and make it available to users through a personalized account and as a part of a wireless prescription reminder service. The system helps users access, aggregate, manage, update, automate, and schedule the prescriptions they are currently taking. Users receive real-time wireless prescription dosing reminders based on their prescribed drug, dosage, and other indications, tailored to each individual's daily schedule. These wireless dosing reminders (i) include additional instructional content such as pill images, compliance tools, and Web or WAP drug links, (ii) are automatically scheduled and transmitted based on the user's prescription source data, in conjunction with selections indicated on their personal account, and (iii) are transmitted via SMS, EMS, MMS, WAP, email, and other formats to the user's mobile phone, PDA, or other wireless device. The integrated interface and secondary database system enable a number of additional system features which focus on compliance and management of the underlying source prescription data.

Owner:LAWLESS OLIVER CHARLES

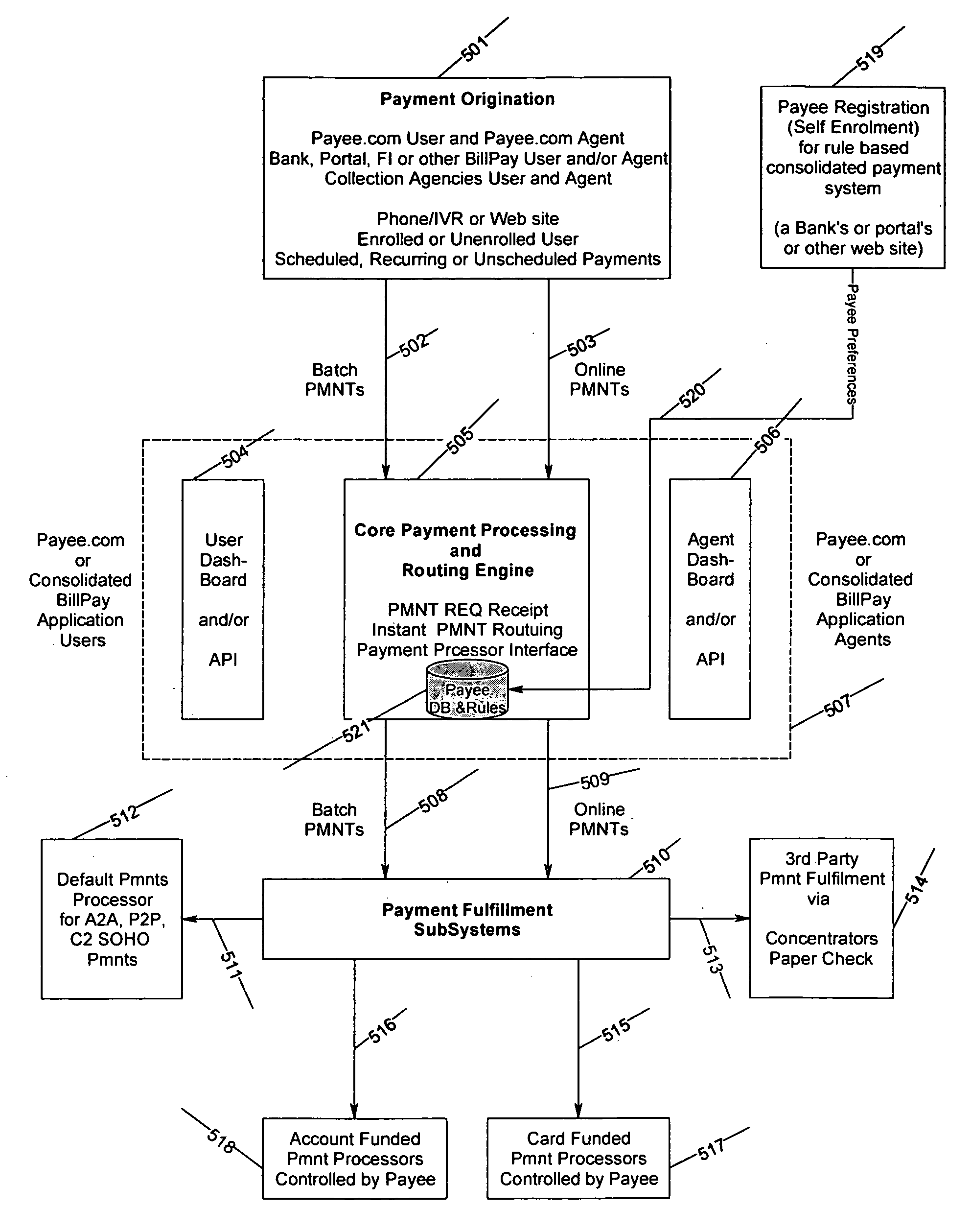

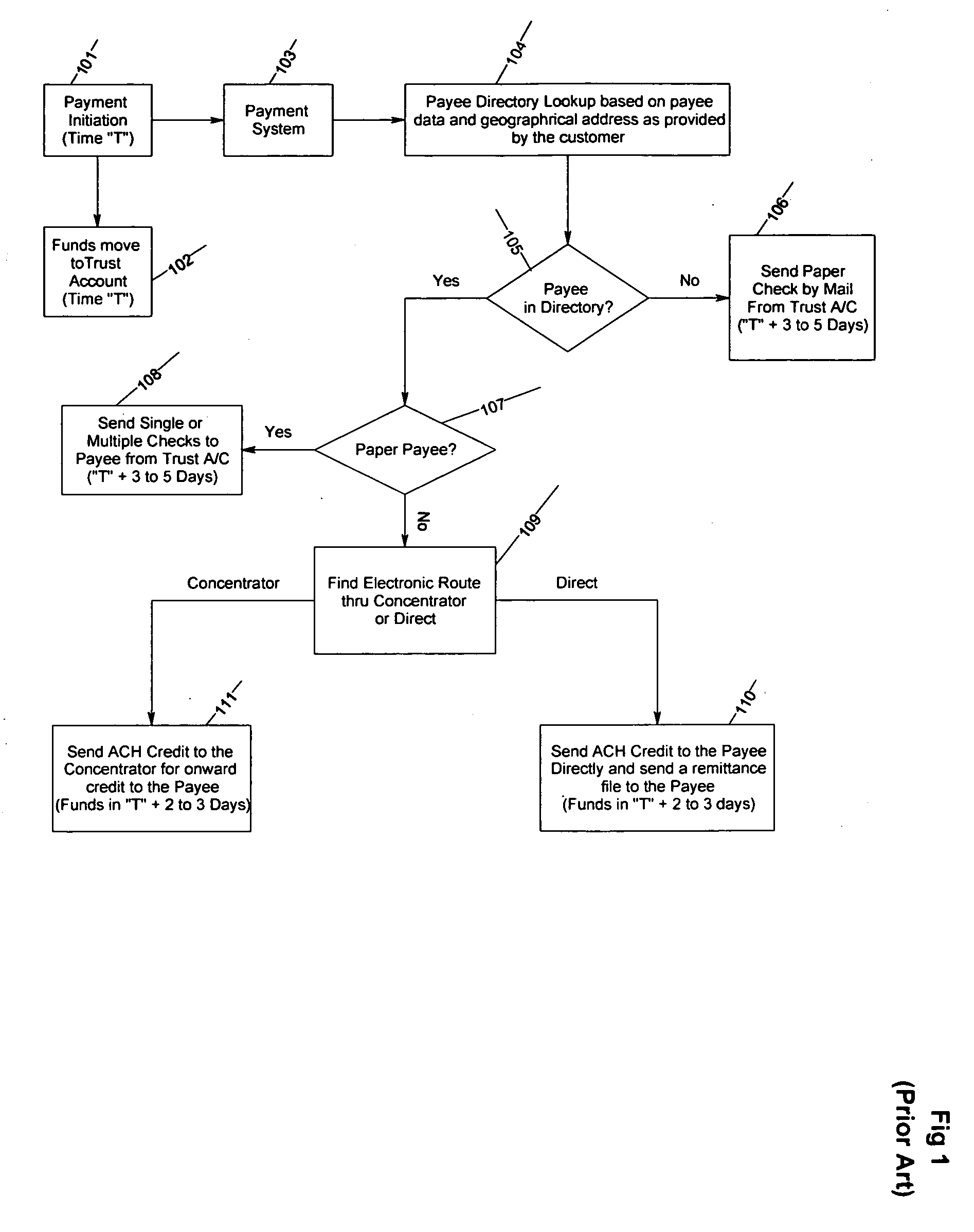

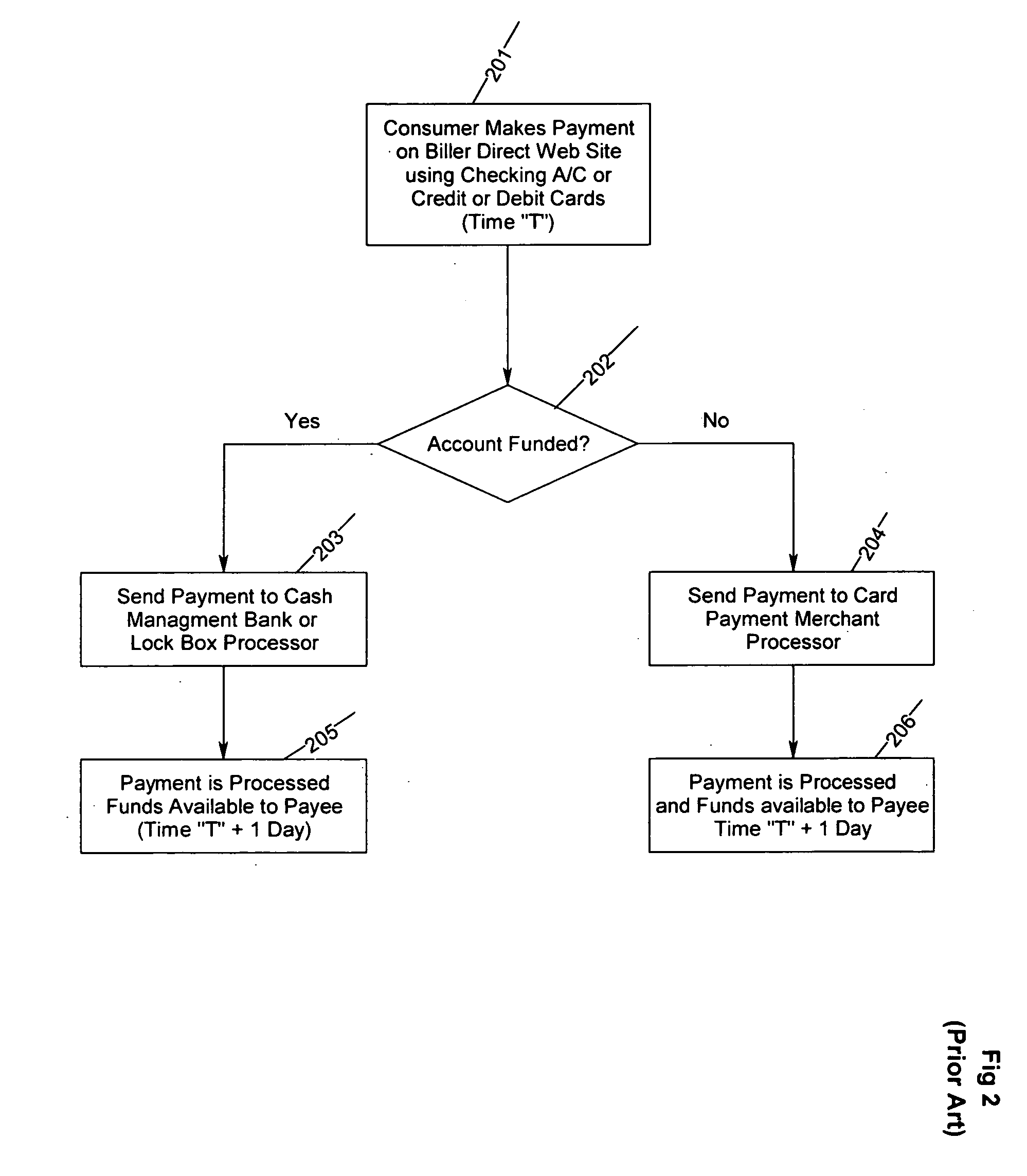

Electronic payment system for financial institutions and companies to receive online payments

InactiveUS20060206425A1Improve consumer experienceHigh speedFinanceProtocol authorisationPayment transactionPersonal account

The present invention provides an a electronic payment system for bank, financial institutions, portals and companies to receive payment from their customers for one or more payees. The electronic payment system allows payer (consumer or business) to use any funding method (bank account, credit / debit cards or any other business or personal account or method associated with one or more banks) accepted by the payee to initiate a payment and the payment transaction is routed to the appropriate payment processor based on payee's preferences. The electronic payment system also provides a instant payment delivery notification to the payer directly from the payee. The system also creates a unique payment tracking number which can be used by all parties associated with the transaction to track a payment's status and other attributes associated with the payment. The electronic payment system also provides a rule based payment management system for the payees to use for managing the processing and posting of the payments. The system also allows for payees to manage their payments received and post to various receivable systems based on rules defined. Additionally, the system allows payees to create rules for other aspects of payment processing. The system also allows for much simplified electronic bill delivery system which uses biller's existing infrastructure to create bill data for distribution to 3rd party consolidators.

Owner:PAYMENTUS CORP

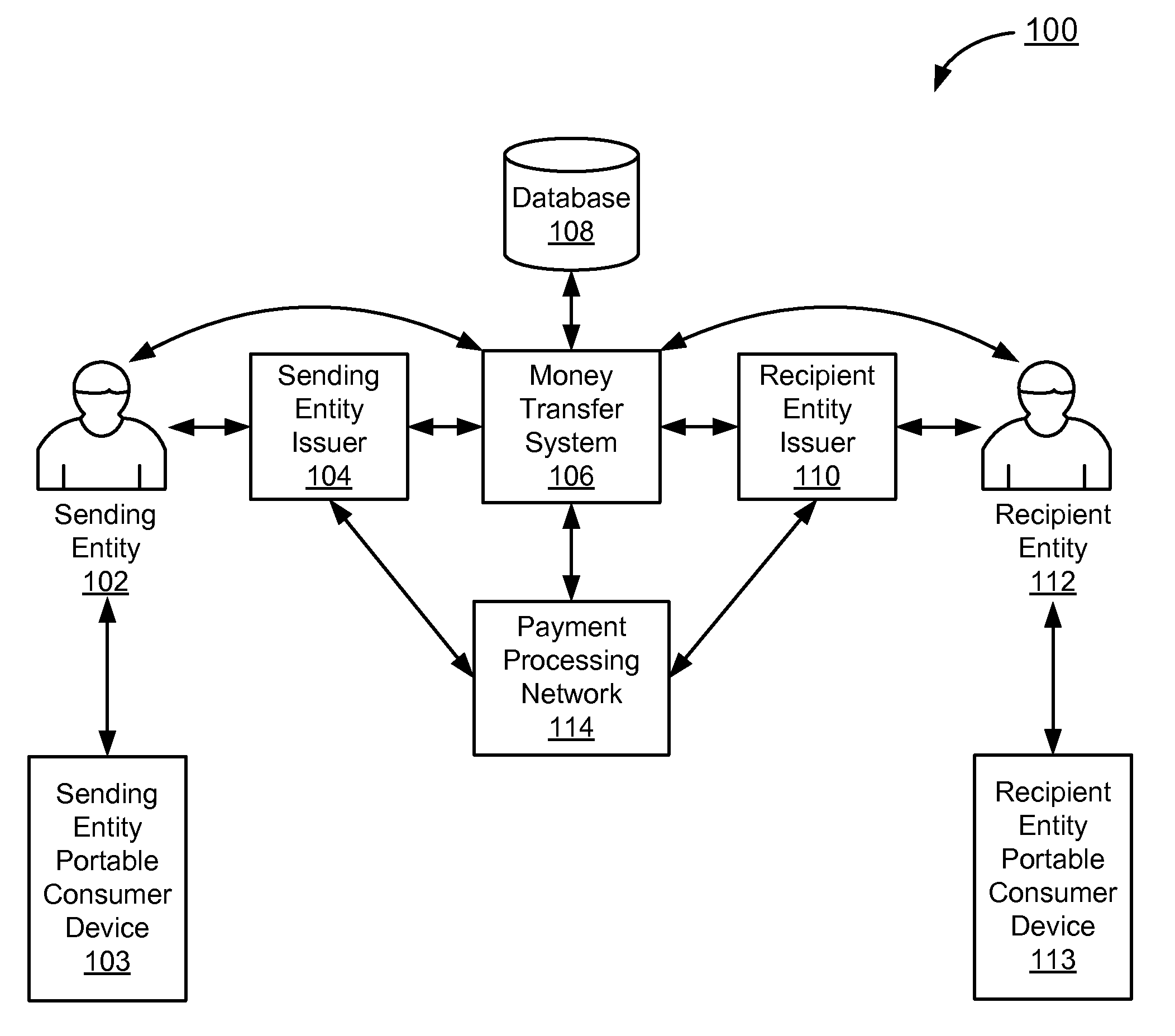

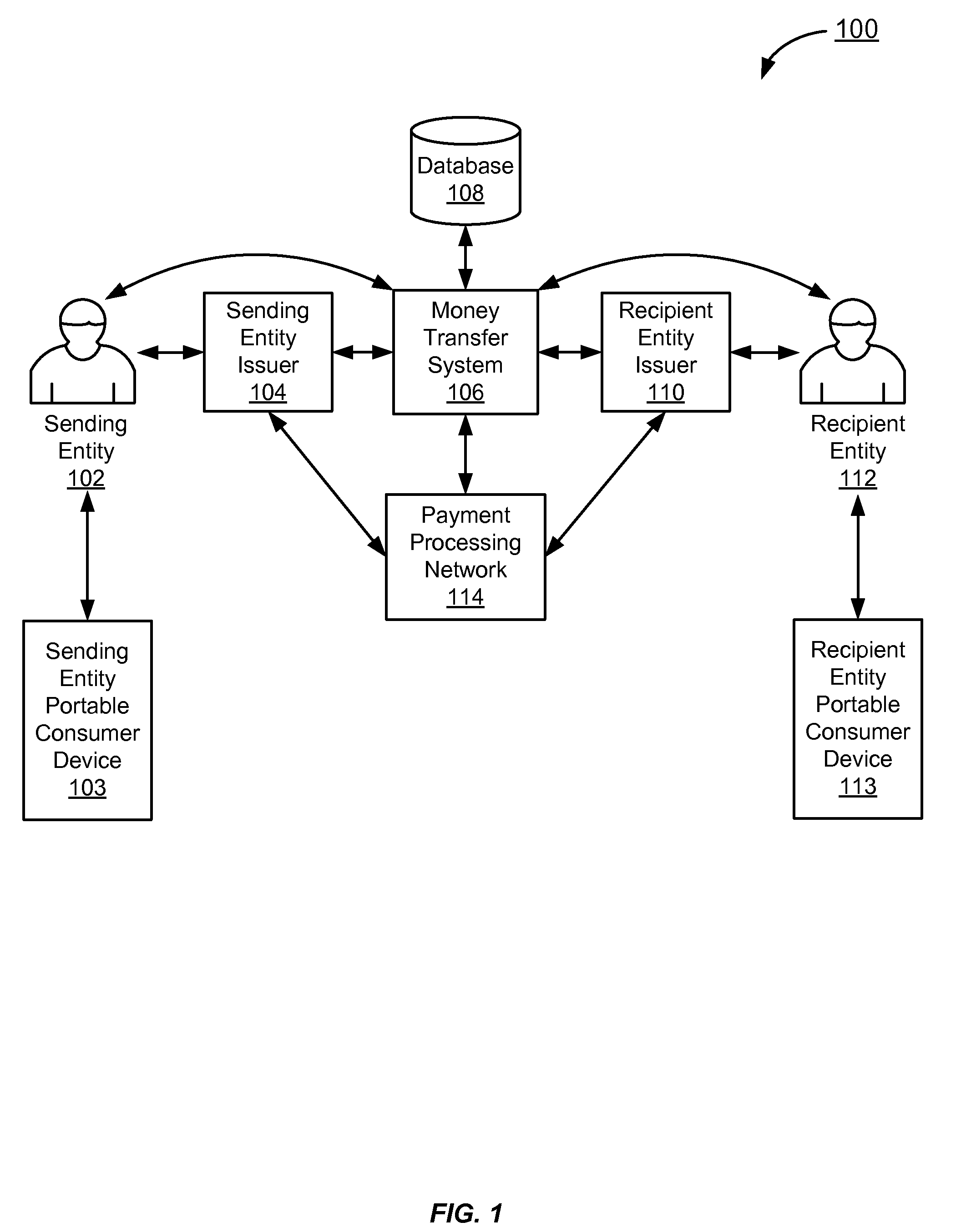

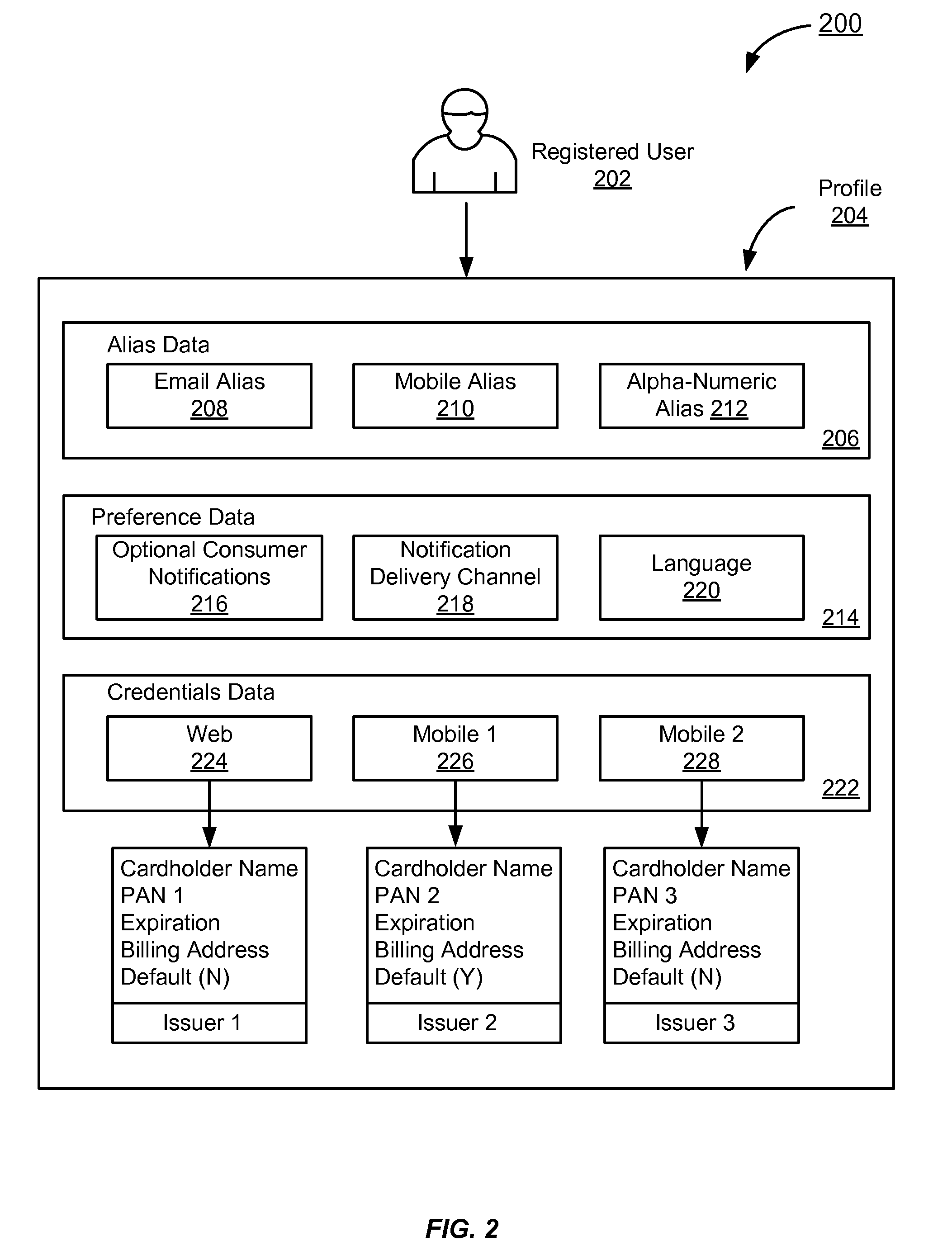

Portable consumer device with funds transfer processing

A portable consumer device with funds transfer processing systems and methods are disclosed. A sending entity may initiate a money transfer from one portable consumer device, such as a credit or debit card, to another portable consumer device through a money transfer system. A sending entity may initiate a payment request and the money transfer system may prompt the sending entity to use one of a plurality of payment account identifiers it possess. A recipient entity is defined by either an alias or a recipient entity personal account identifier. Additionally, an unregistered recipient entity may return a claim code to the money transfer system to claim a money transfer.

Owner:VISA INT SERVICE ASSOC

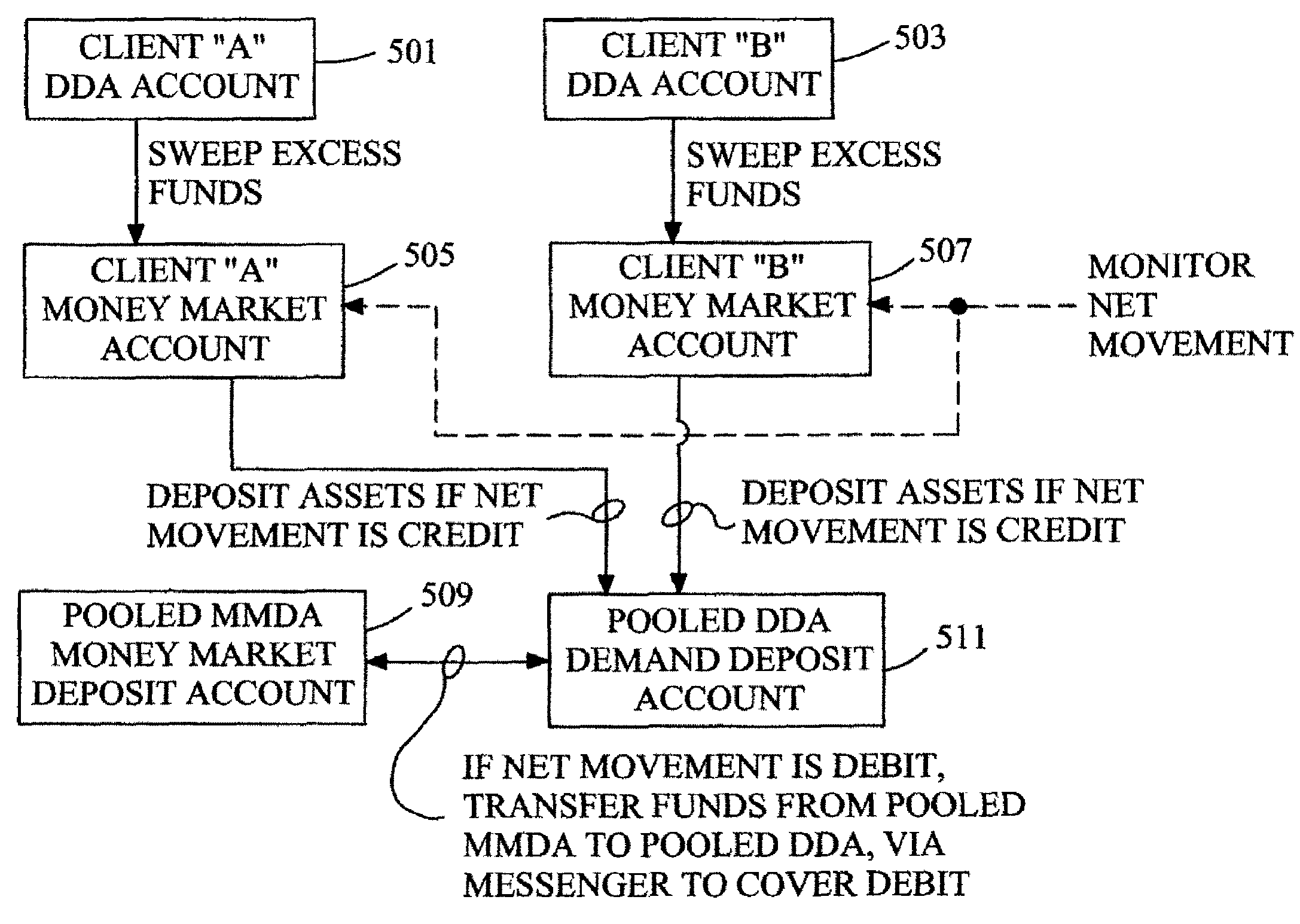

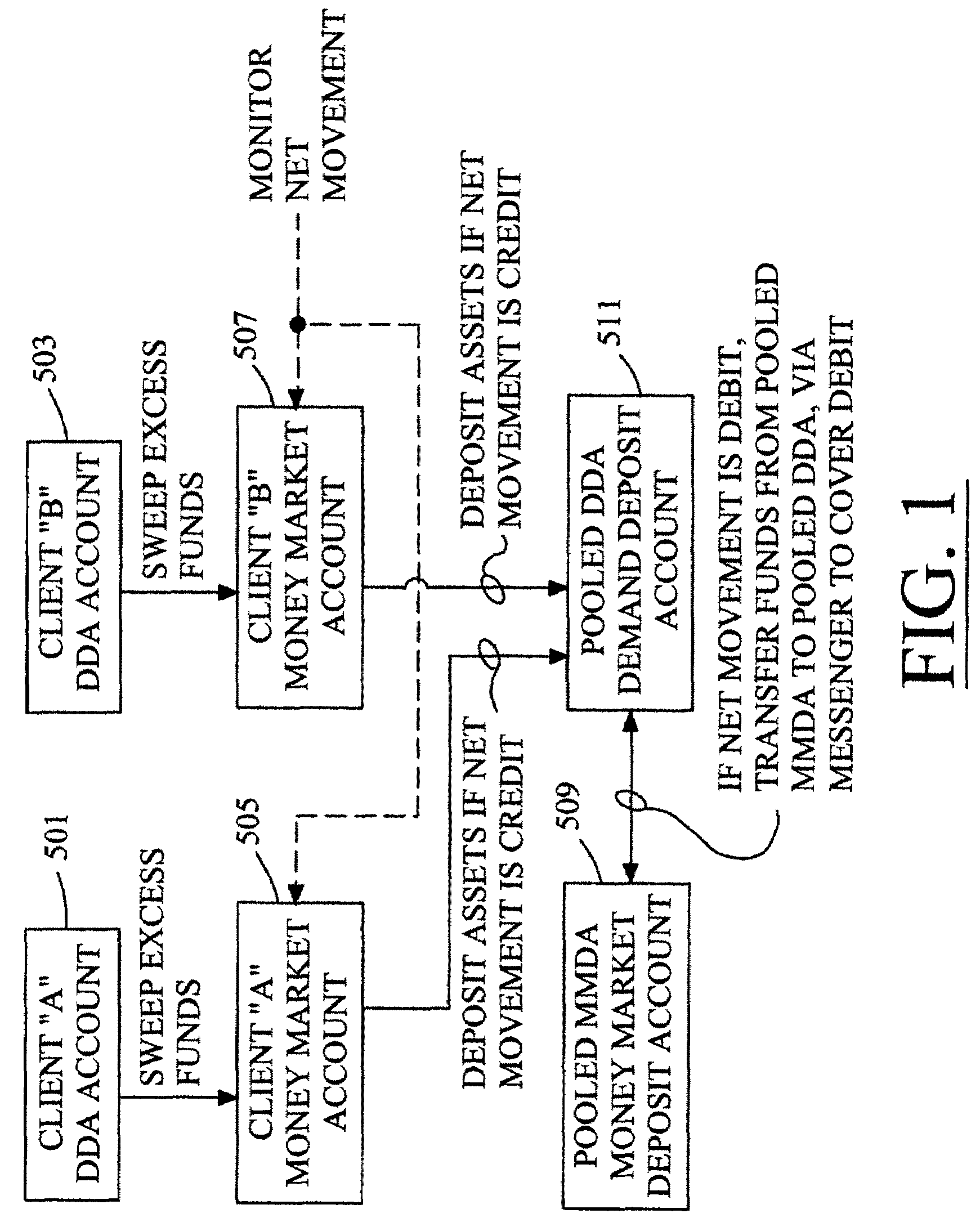

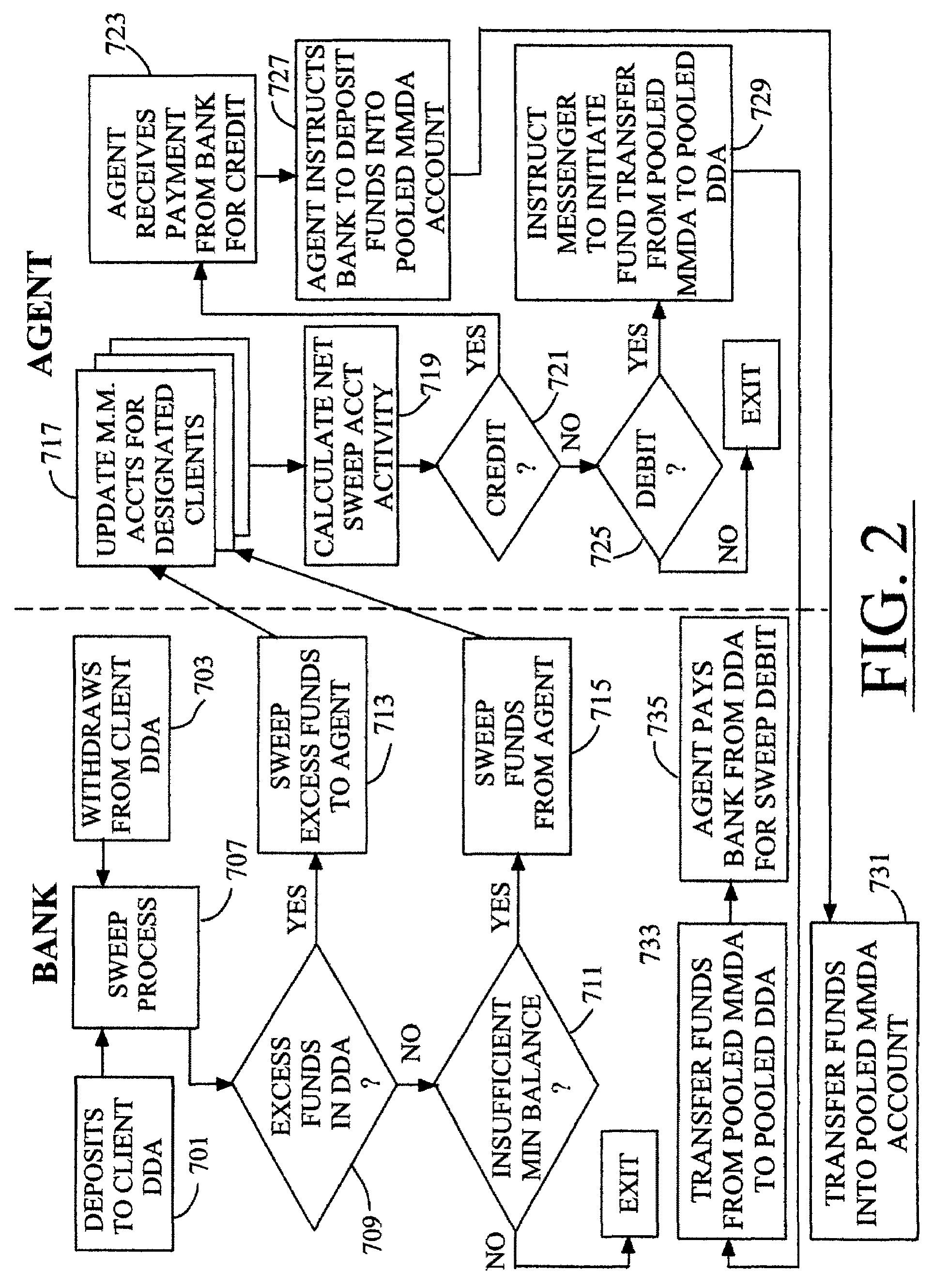

Systems and methods for administering return sweep accounts

Novel systems and methods for managing a plurality of client demand accounts so as to allow a banking institution to retain client deposits on the bank's balance sheets while, at the same time, providing the client with the capability of implementing up to an unlimited number of transactions per month and also providing the client with interest on their account balances. These objectives are achieved through the use of a pooled deposit account at the client's savings institution or bank. Funds are transferred from individual client demand accounts to the pooled insured deposit account. All or a portion of the interest accrued from the pooled deposit account is then distributed to individual clients. The interest may, but need not, be distributed according to the relative proportions of each client's funds in the pooled deposit account. A database keeps track of deposits to, and withdrawals from, each of the client demand accounts, as well as each client's proportionate and / or monetary share in the pooled deposit account. On a regular, periodic, or recurring basis, a net transaction is calculated as the sum of individual client deposits and withdrawals from the plurality of demand accounts. The net transaction calculation is used to determine an amount of funds that need to be deposited into the pooled deposit account to cover client deposits, or an amount of funds that needs to be withdrawn from the pooled deposit account to cover client withdrawals. Individual account management calculations are performed to determine whether to deposit or withdraw funds from the pooled deposit account to each of a plurality of individual client demand accounts. The database is updated for each client's deposit and withdrawal activities. The invention permits funds to be deposited into a demand account from various sources, and also provides for the tendering of payments from the demand account via different instruments, without limitation as to the number of transfers, and with accrual of interest on the deposited funds.

Owner:ISLAND INTPROP

Integrated prescription management and compliance system

A system and method for prescription therapy management and compliance are provided. The system framework integrates primary databases from pharmacies, pharmacy benefit managers (PBMs), health plans, and EHR providers with a secondary database system, user interface, and wireless messaging platform, in order to extract and aggregate user-specific prescription data and make it available to users through a personalized account and as a part of a wireless prescription reminder service. The system helps users access, aggregate, manage, update, automate, and schedule the prescriptions they are currently taking. Users receive real-time wireless prescription dosing reminders based on their prescribed drug, dosage, and other indications, tailored to each individual's daily schedule. These wireless dosing reminders (i) include additional instructional content such as pill images, compliance tools, and Web or WAP drug links, (ii) are automatically scheduled and transmitted based on the user's prescription source data, in conjunction with selections indicated on their personal account, and (iii) are transmitted via SMS, EMS, MMS, WAP, email, and other formats to the user's mobile phone, PDA, or other wireless device. The integrated interface and secondary database system enable a number of additional system features which focus on compliance and management of the underlying source prescription data.

Owner:LAWLESS OLIVER CHARLES

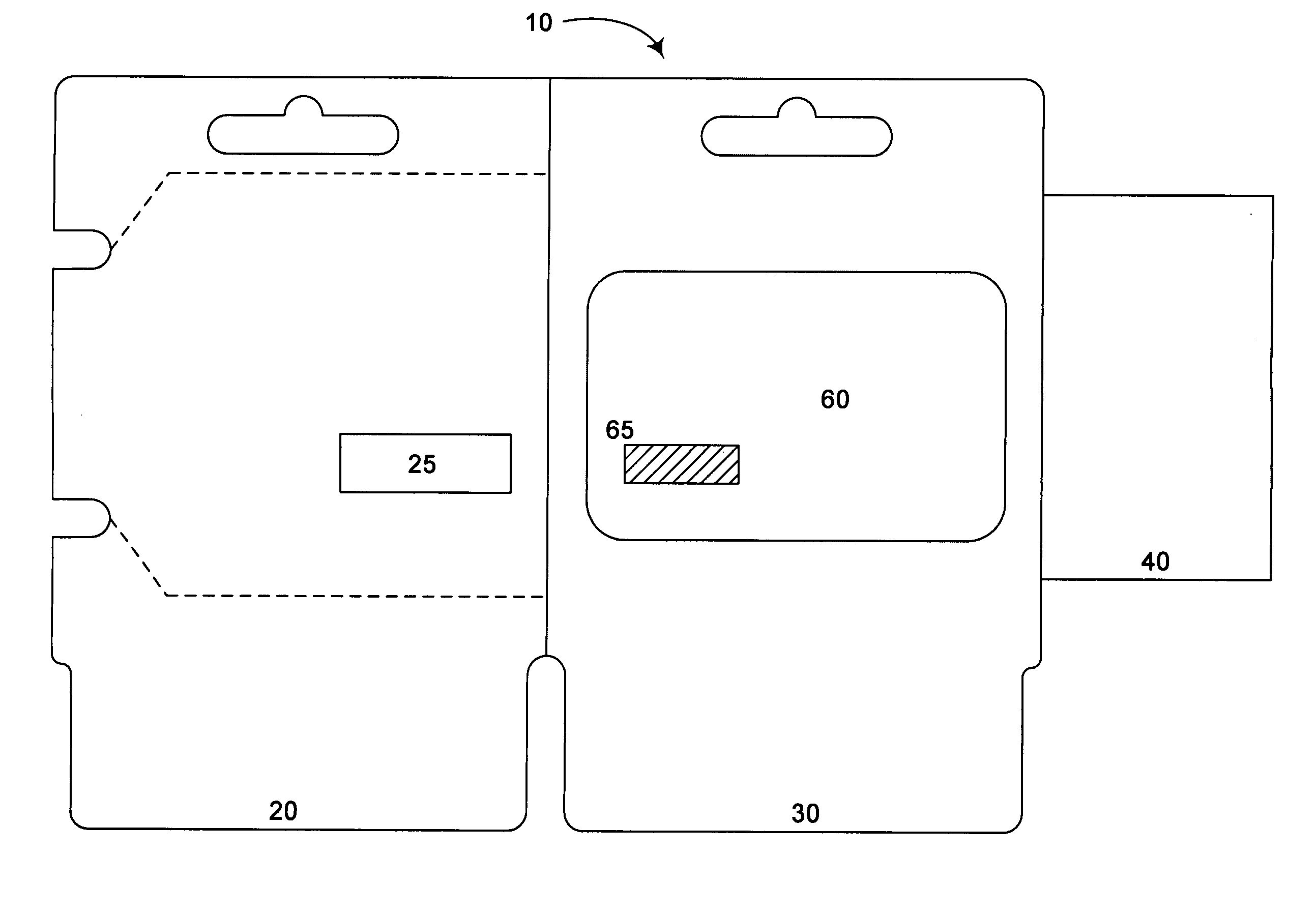

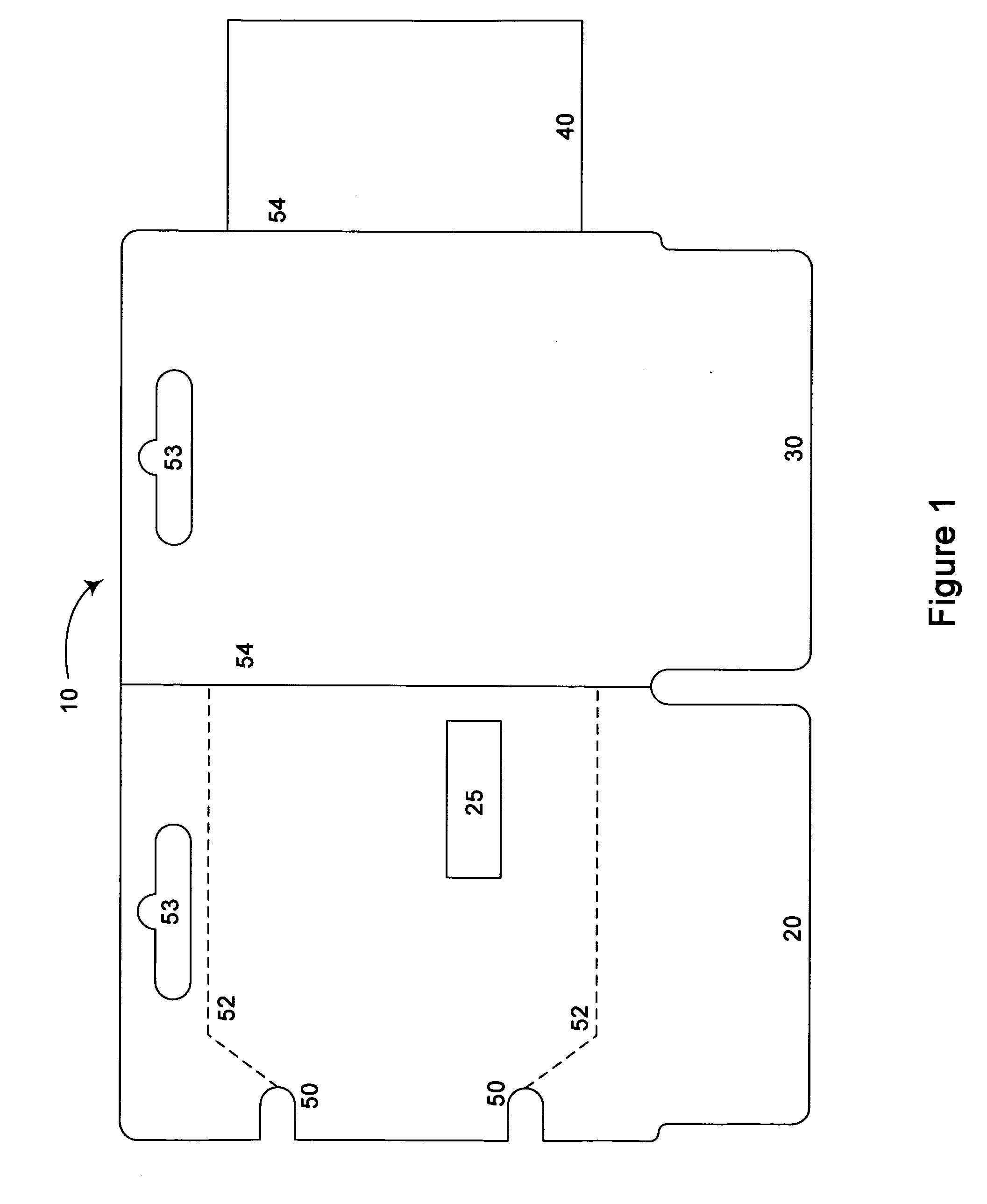

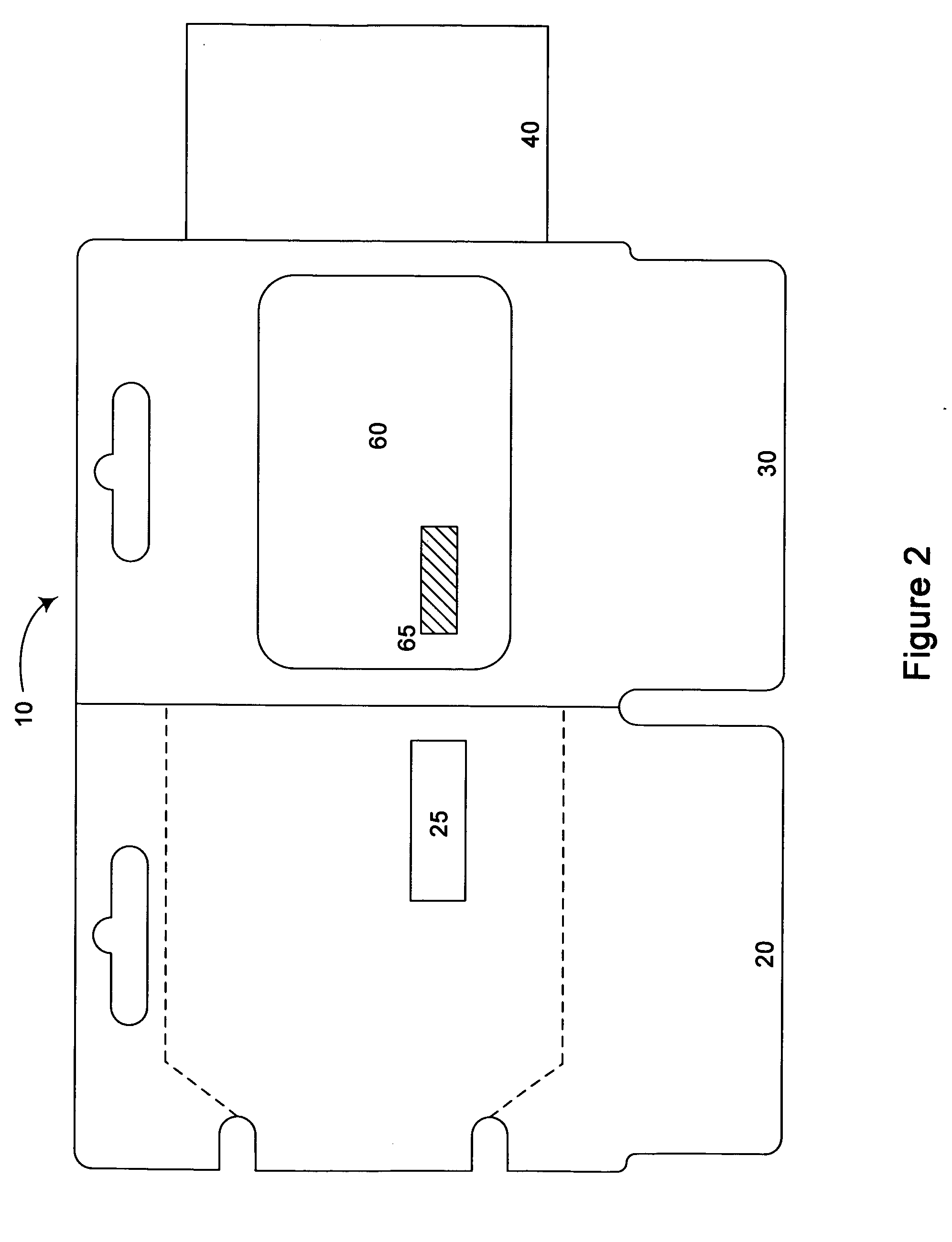

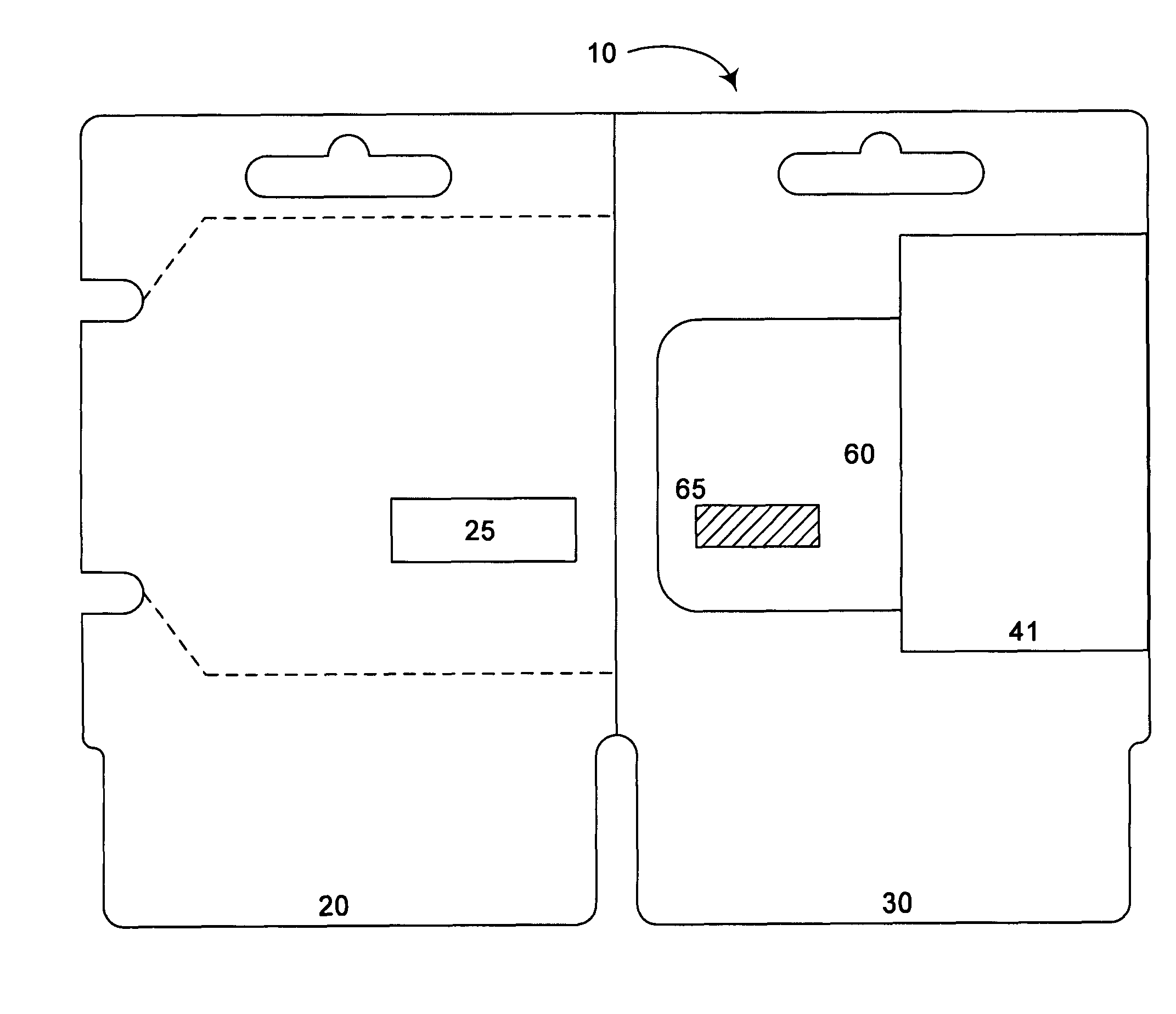

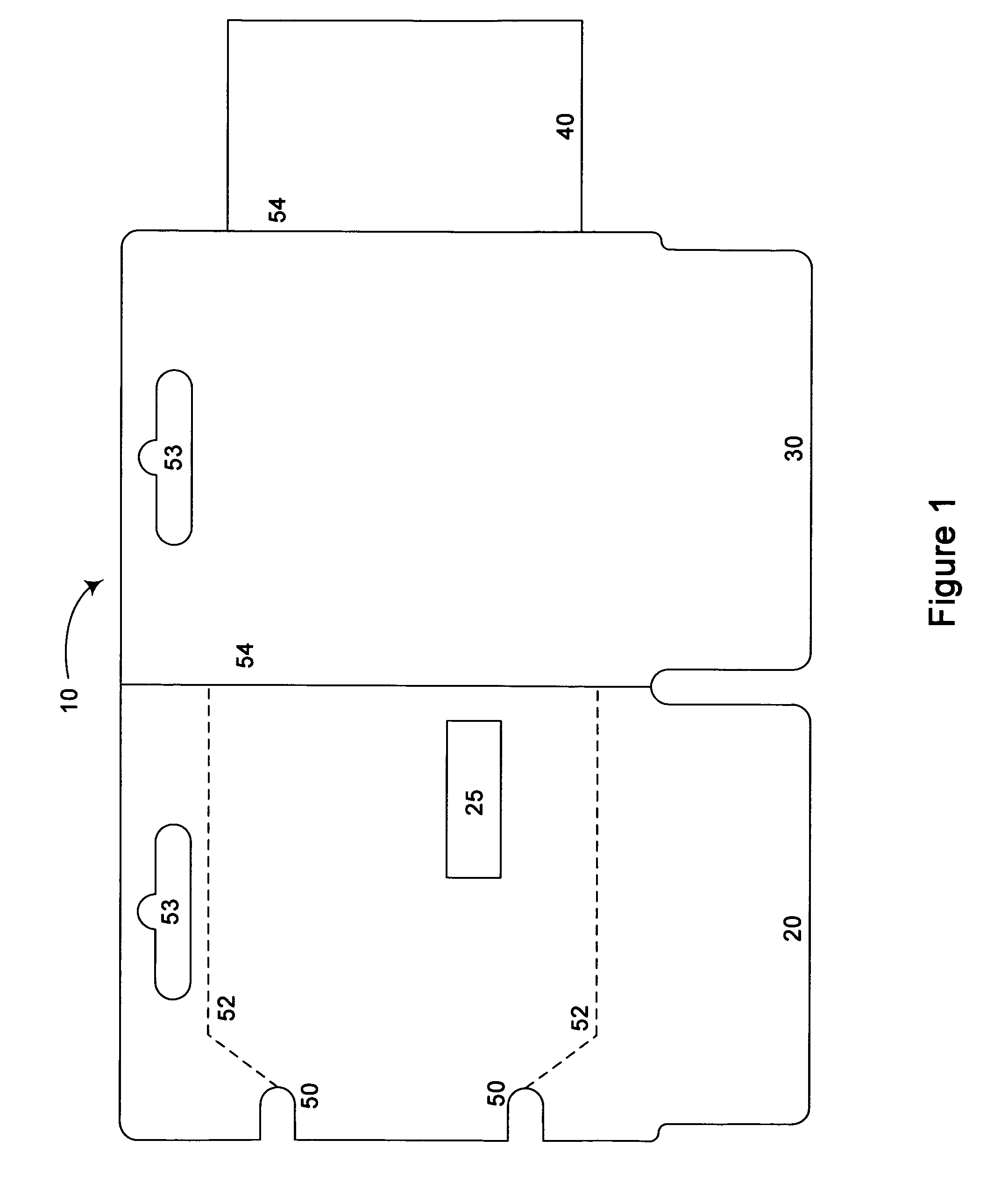

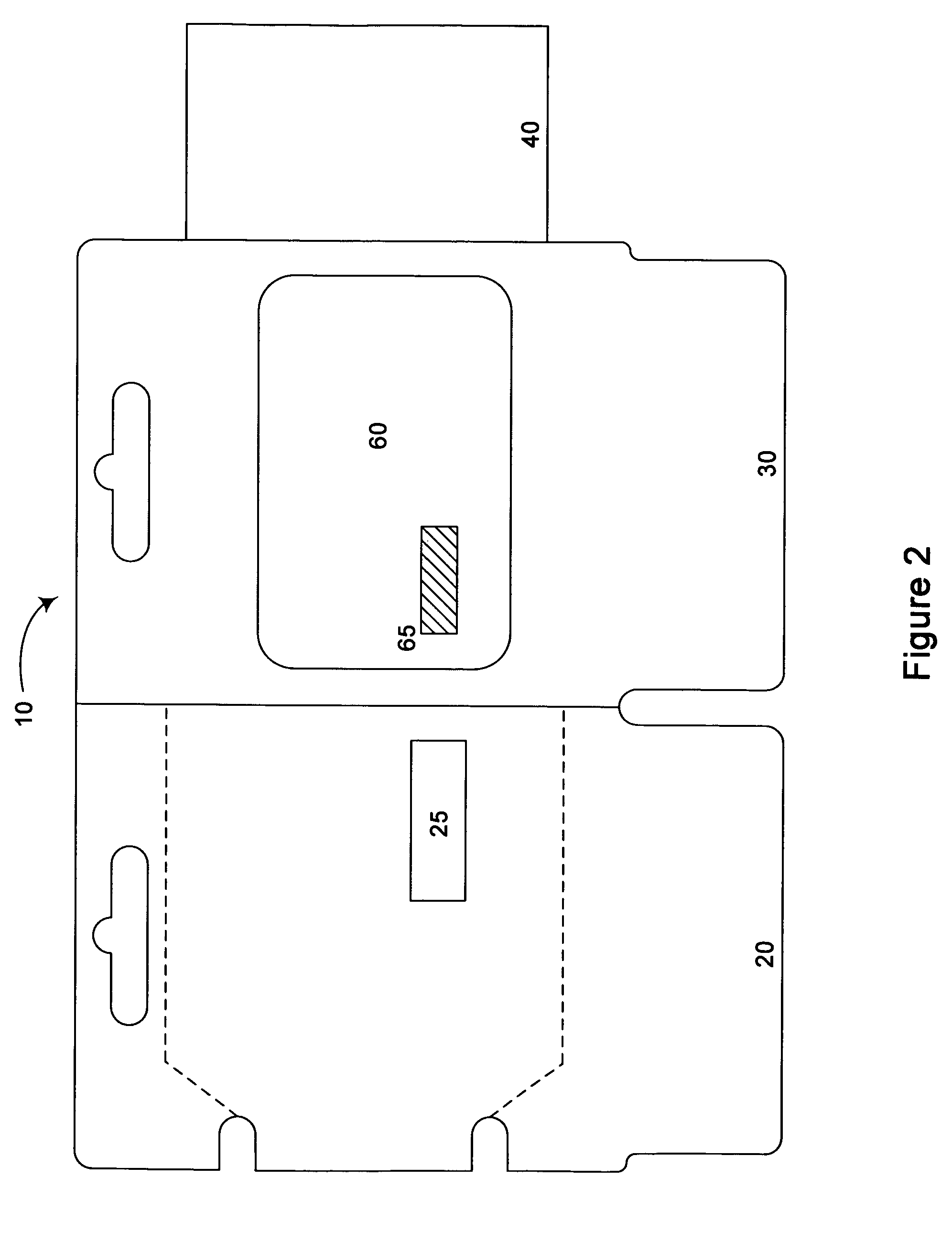

Foldable data card assembly and method

ActiveUS20070063052A1Avoid assemblyCredit registering devices actuationOther printing matterComputer hardwarePersonal account

A foldable data card assembly and method are disclosed. The foldable data card assembly comprises a base assembly with a left portion, a middle portion, and a right potion. The left portion or the middle portion contains an aperture. A data card is enclosed within the base assembly such that the aperture is aligned with a special number on the data card. A security barrier is placed adjacent to the personal account number on the data card, but the security barrier is not placed between the aperture and the special number on the card. During manufacture, the special number is read from the card through the aperture, and the special number used to generate activation information which is printed on the package. The activation information is read at the point of sale, and used to activate the account associated with the activation information.

Owner:E2INTERACTIVE INC D B A E2INTERACTIVE

Transaction method for secure electronic gift cards

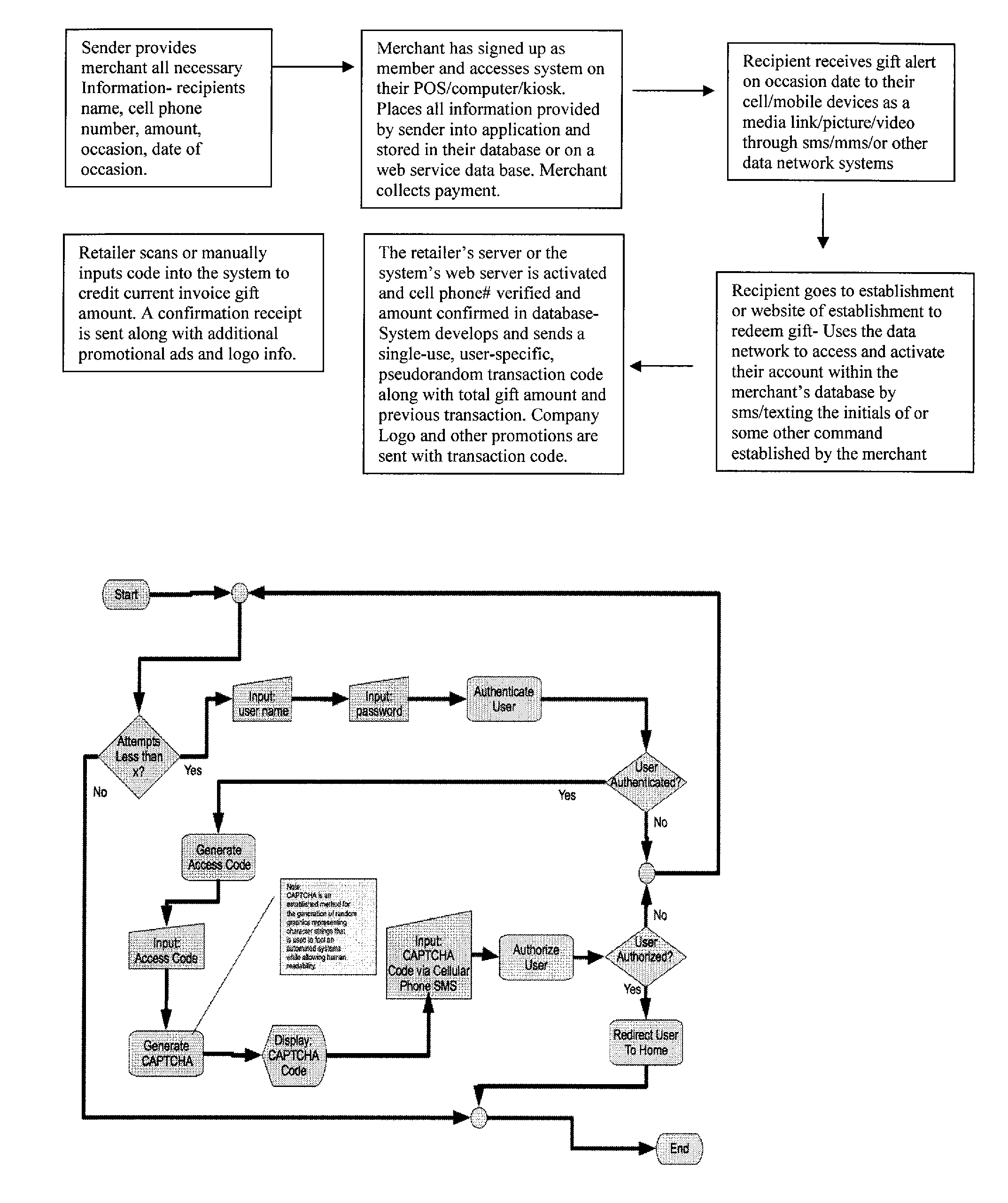

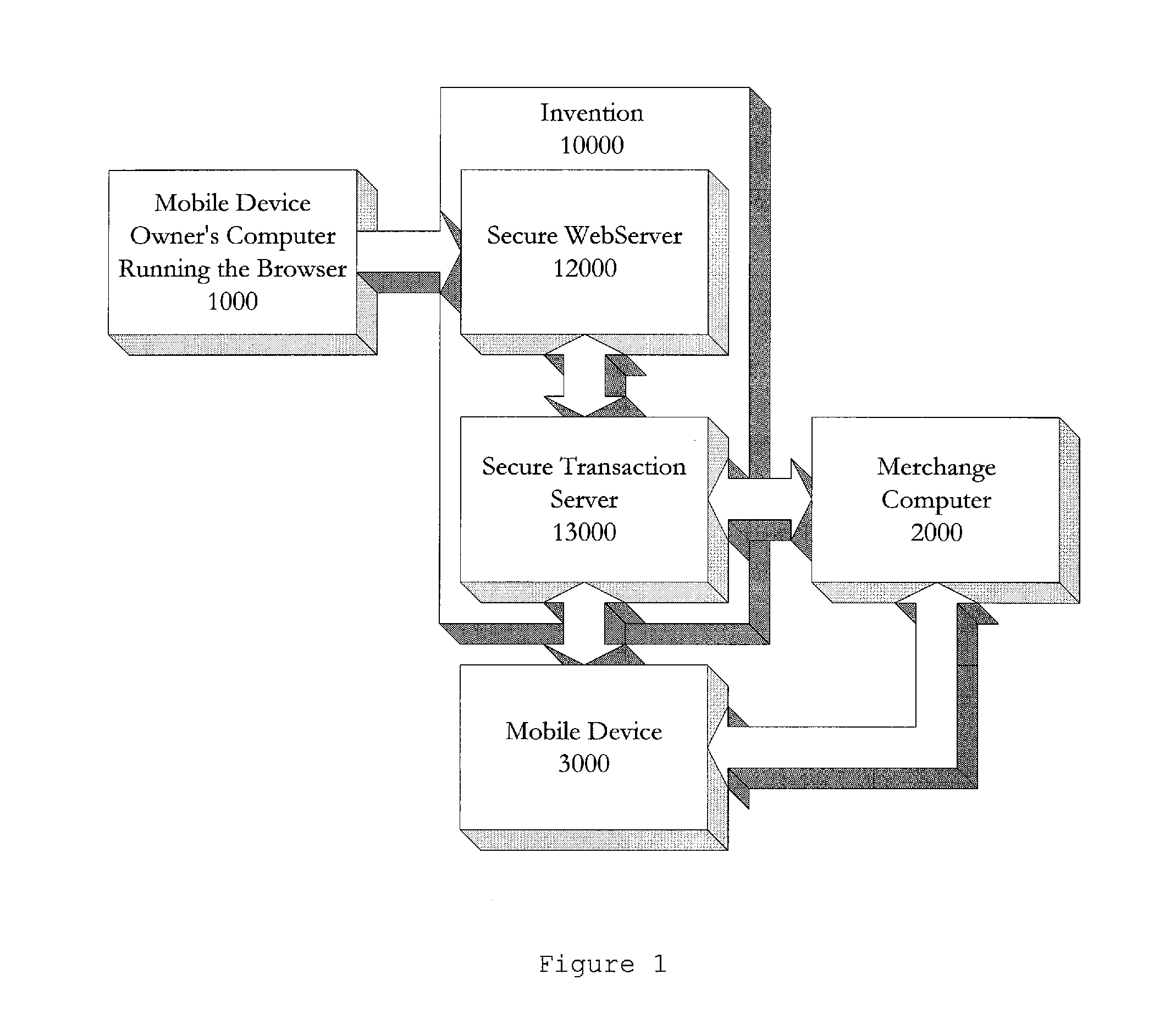

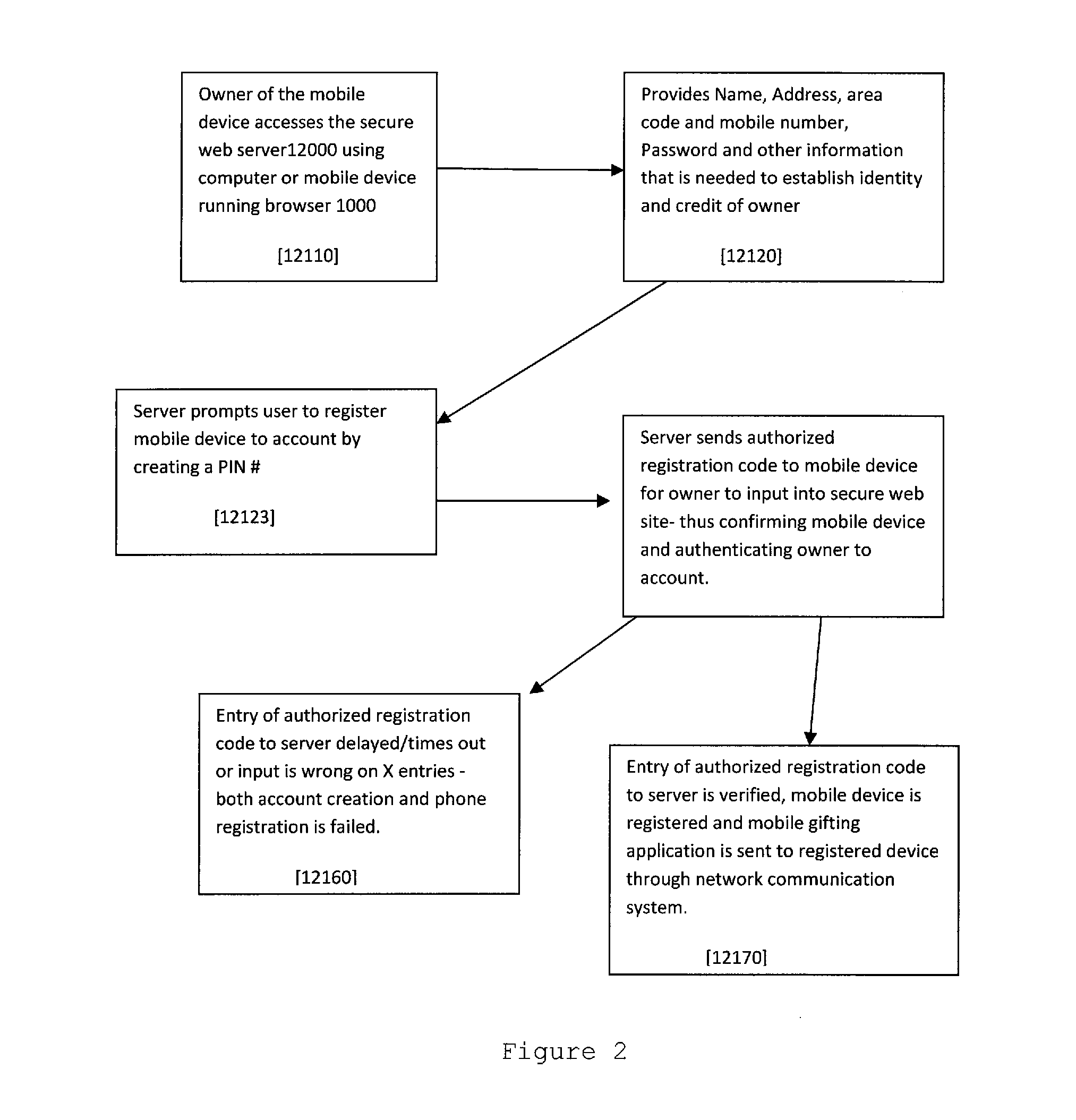

Disclosed is a novel method of sending electronic gift cards. The cards enable people when they are in a hurry and they want to do last minute shopping for special occasions, the holidays, including those special events such as anniversaries, birthdays and special event days. The invention allows anyone with a mobile device to send a personalize “gift card” to anyone else who also has a mobile device anywhere. Through secure personal accounts, the consumer may tell the transaction server, about whom to send the gift to, how much, and select the occasion or customized message. The electronic “gift card” can be in one of the alternative forms, such as just text, image, or video message. The delivery of the “gift card” can be scheduled instantly or anytime in the future. It can also be periodic. The delivery of the card is secured and guaranteed as is the redemption and transaction process. The innovation also allows setup of recurring delivery of gifts as well as reminder alerts of upcoming special events or occasions.

Owner:HRUSKA JOHN

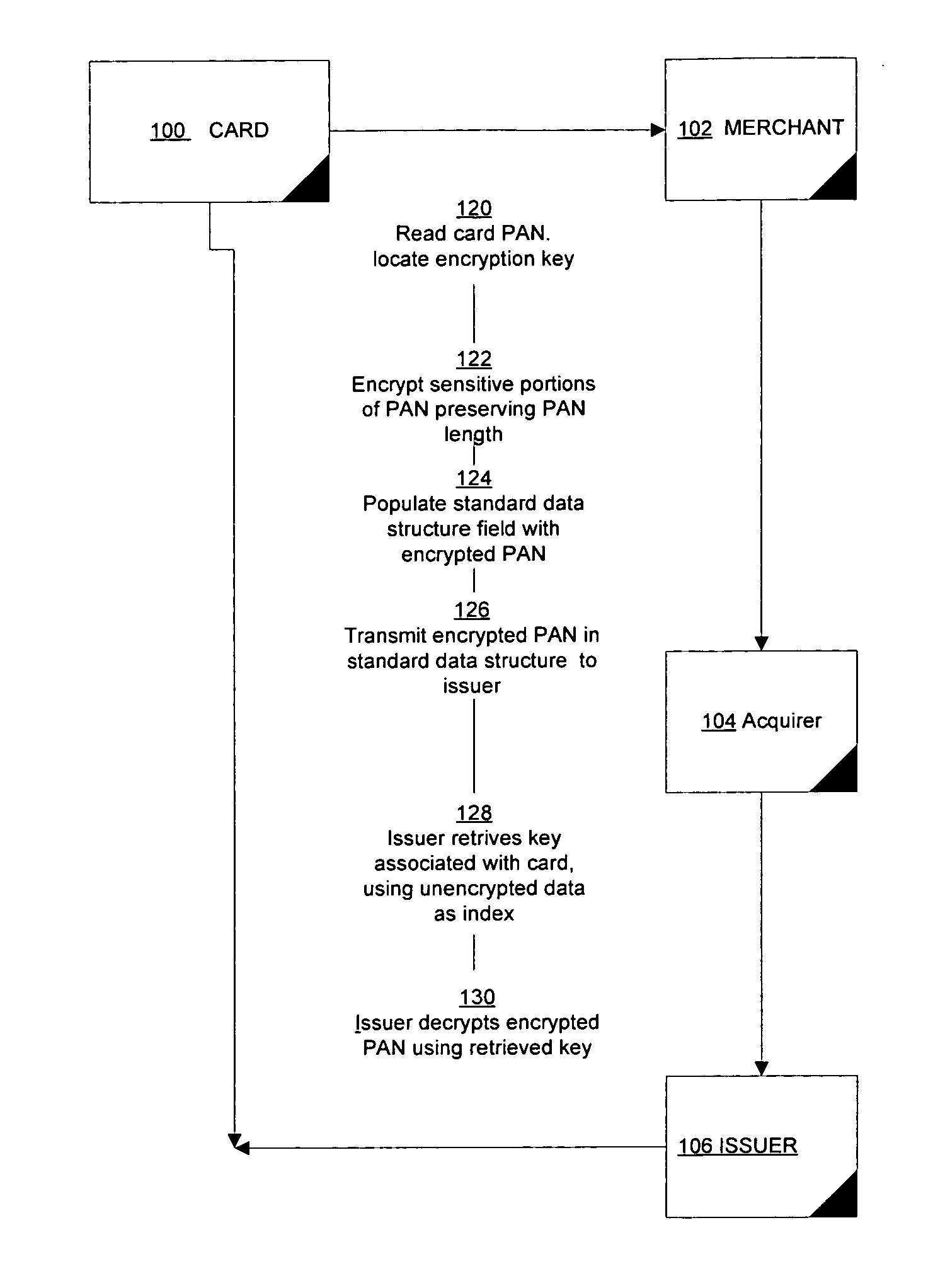

Dynamic encryption of payment card numbers in electronic payment transactions

Systems and methods are provided for secure transmission of information identifying account holders in electronic payment transactions made using payment cards or devices that are based integrated circuit chip technology. Individual cards or devices are associated with a cipher key. Information such as personal account numbers, which may be stored on the cards or devices, is encrypted using a block cipher in a variant of the cipher feedback mode. This manner of encryption preserves the length of the cleartext, and allows the ciphertext to be securely transmitted in standard data structure formats over legacy electronic payment networks.

Owner:MASTERCARD INT INC

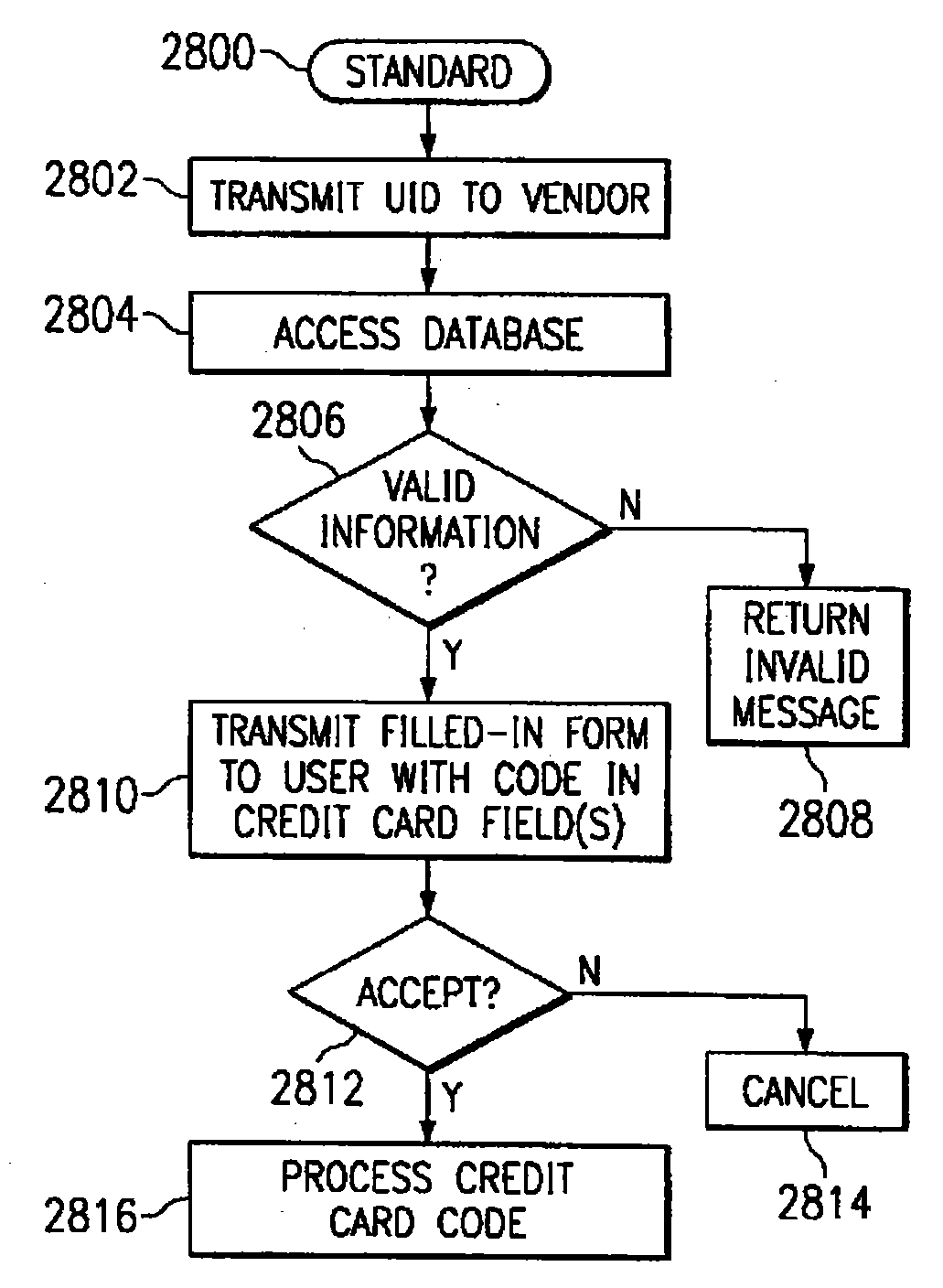

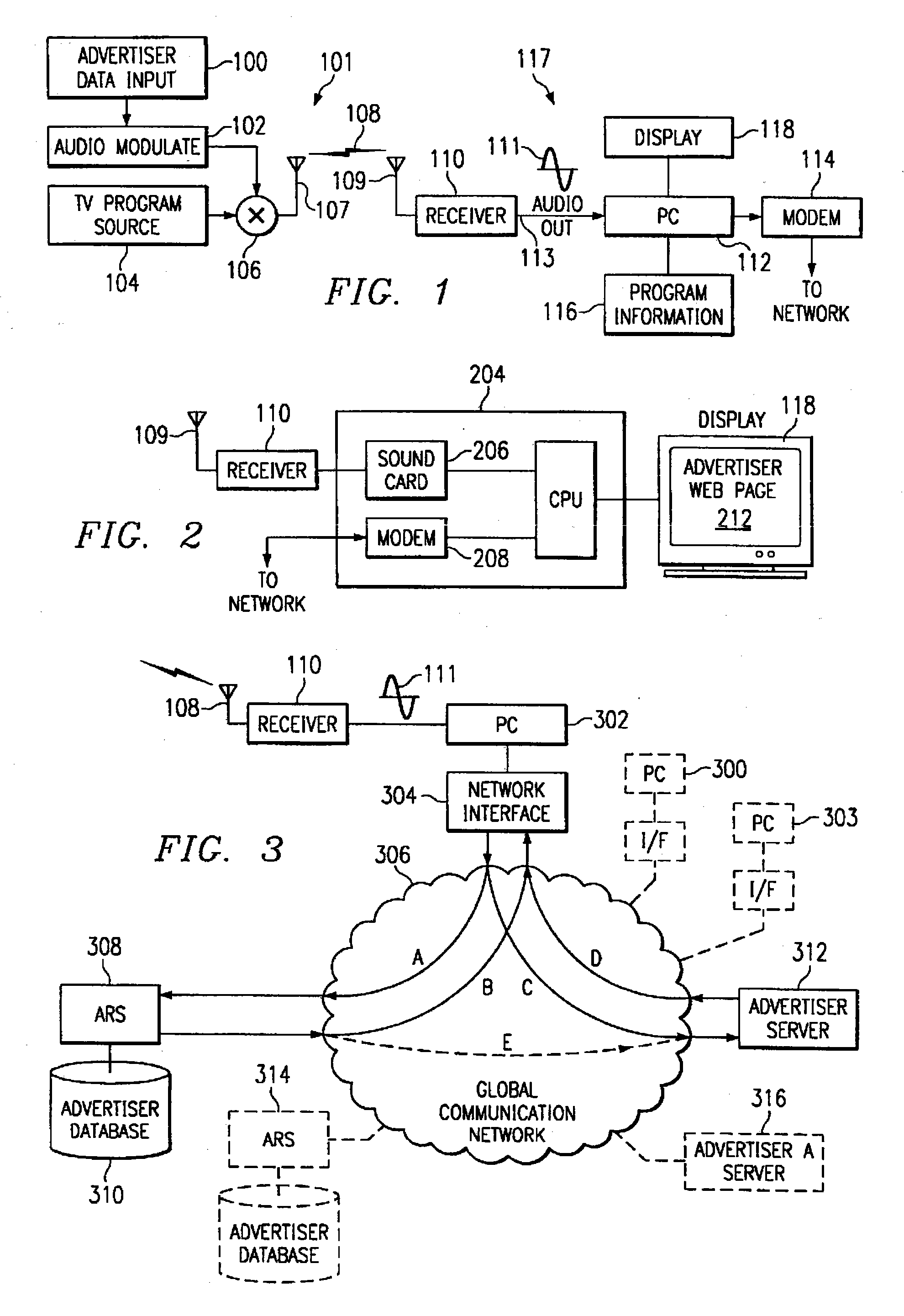

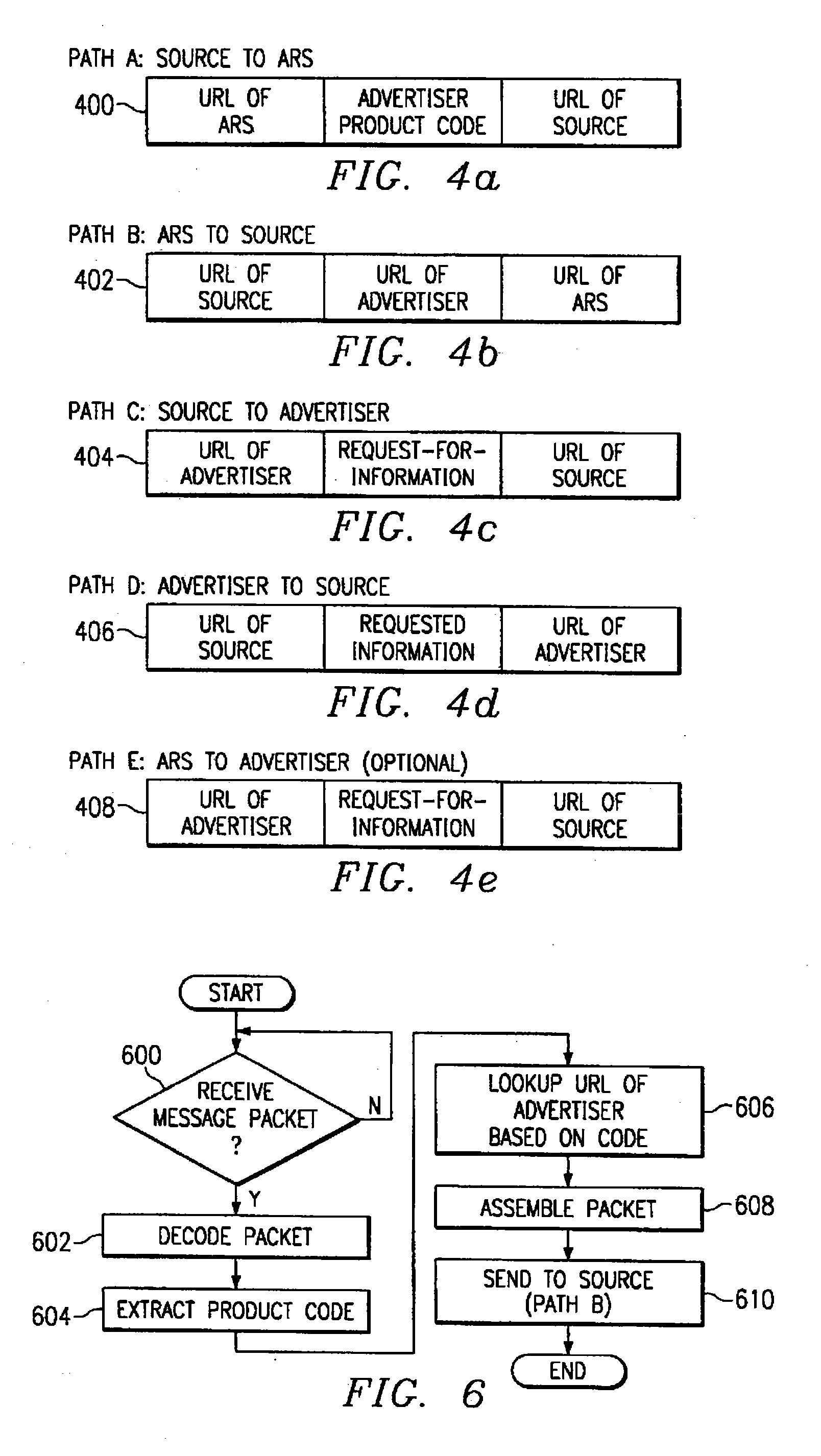

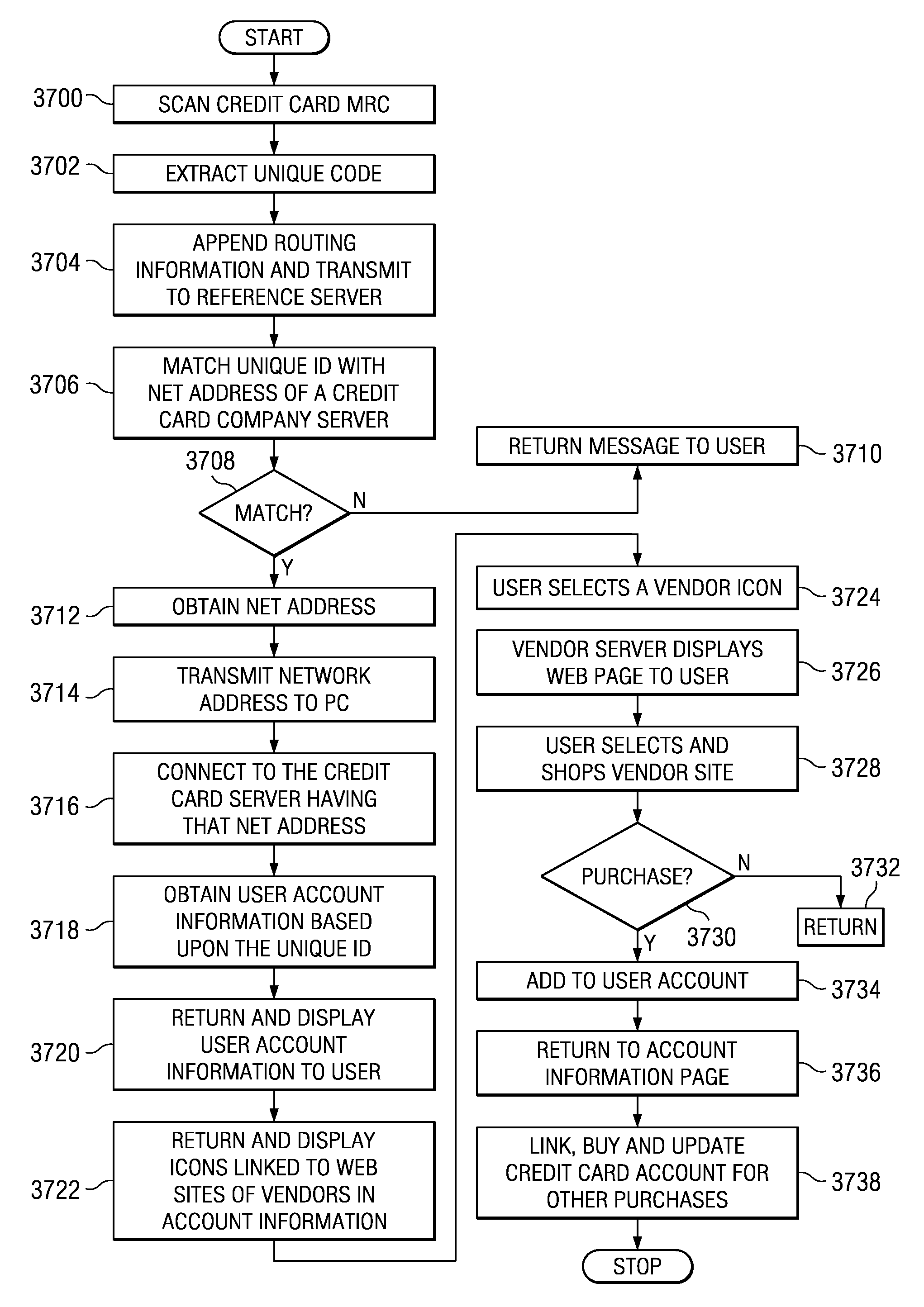

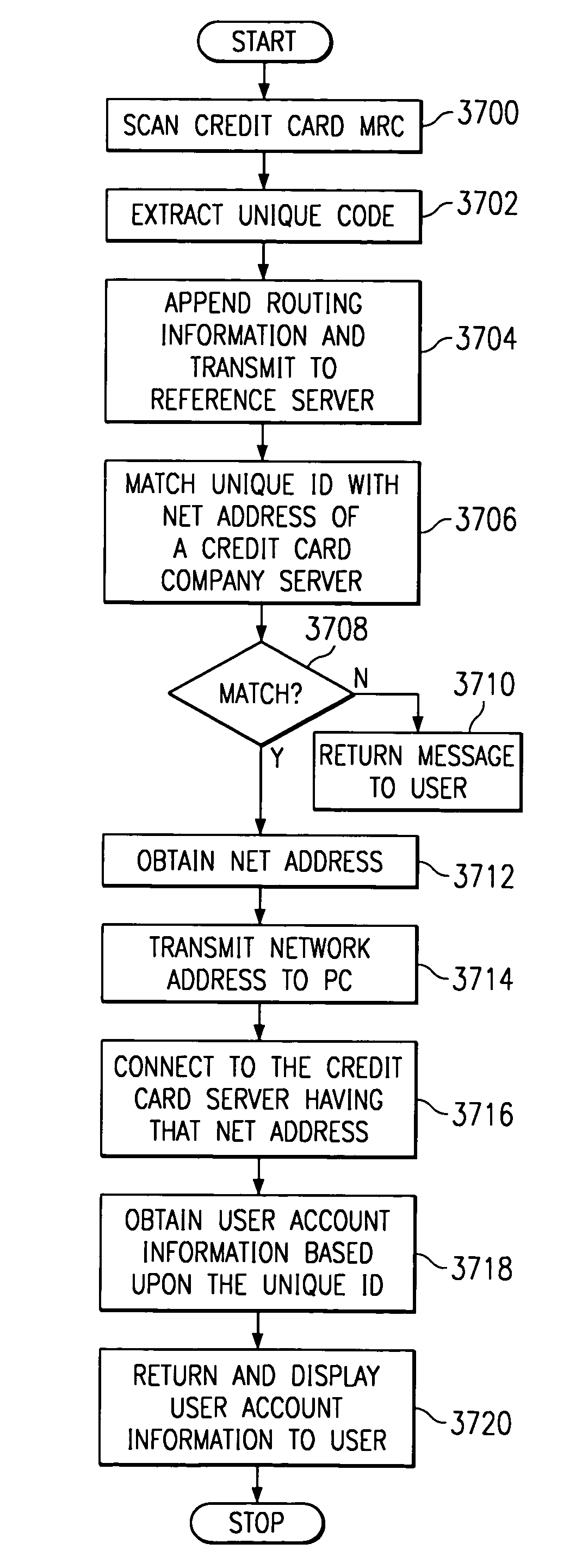

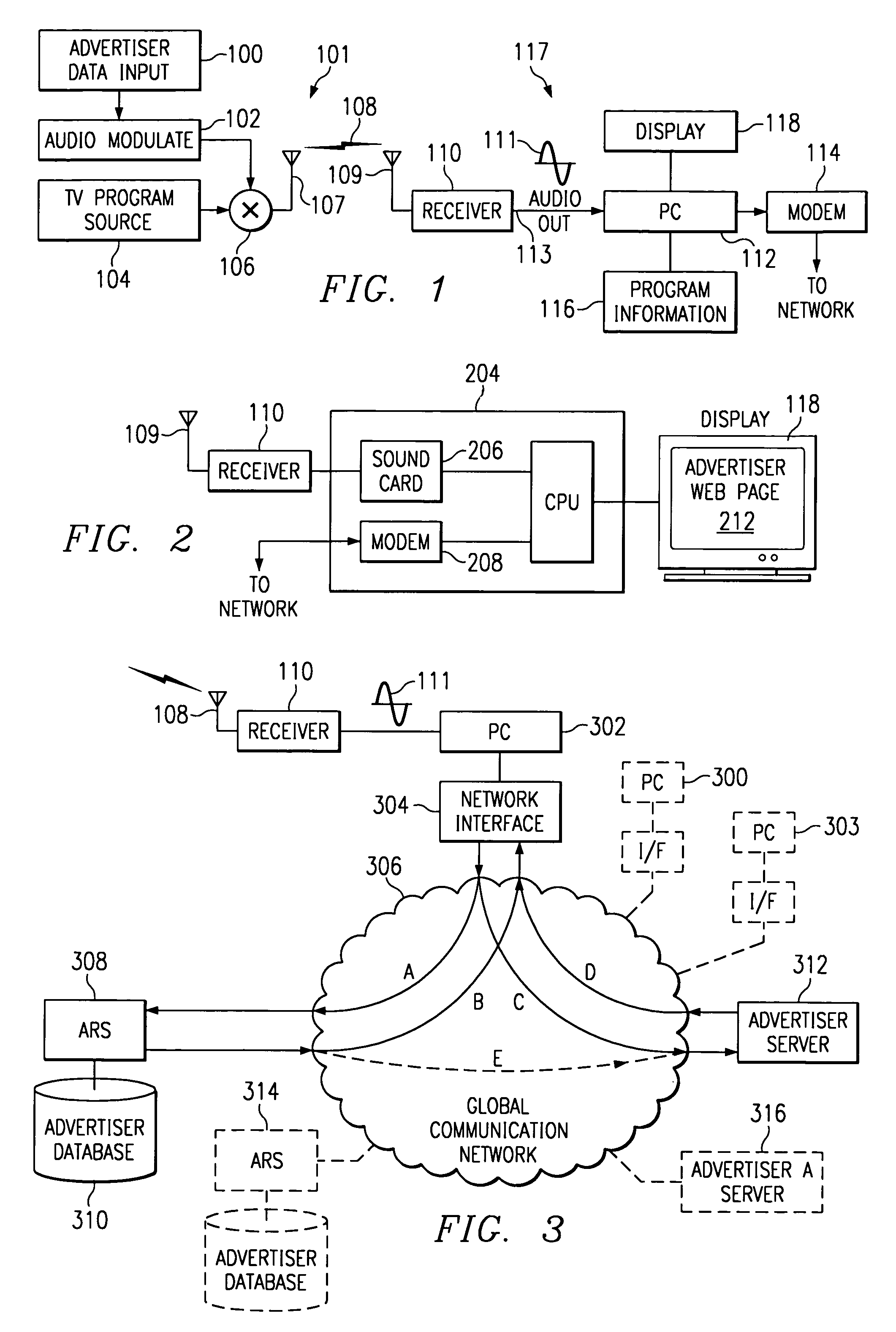

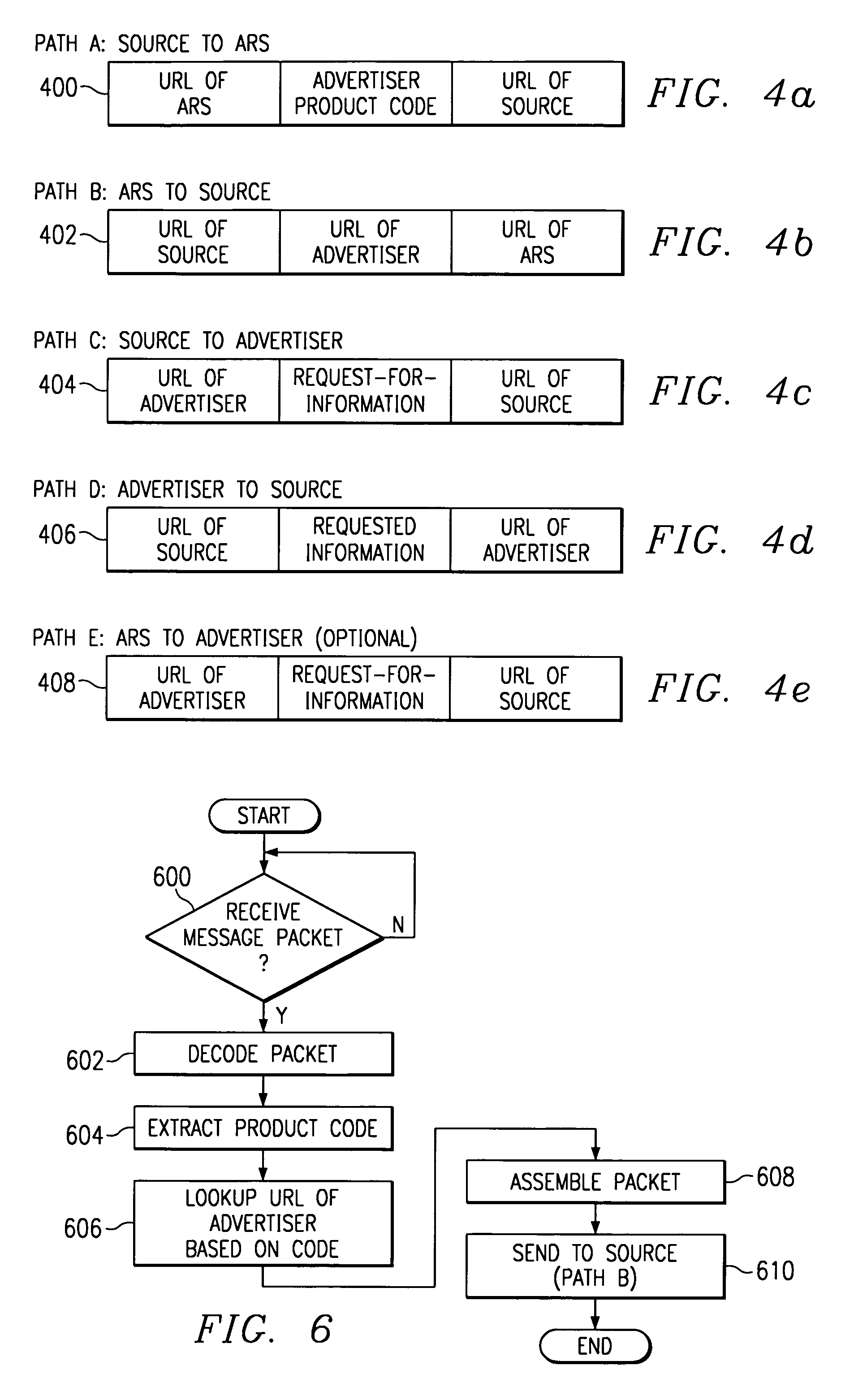

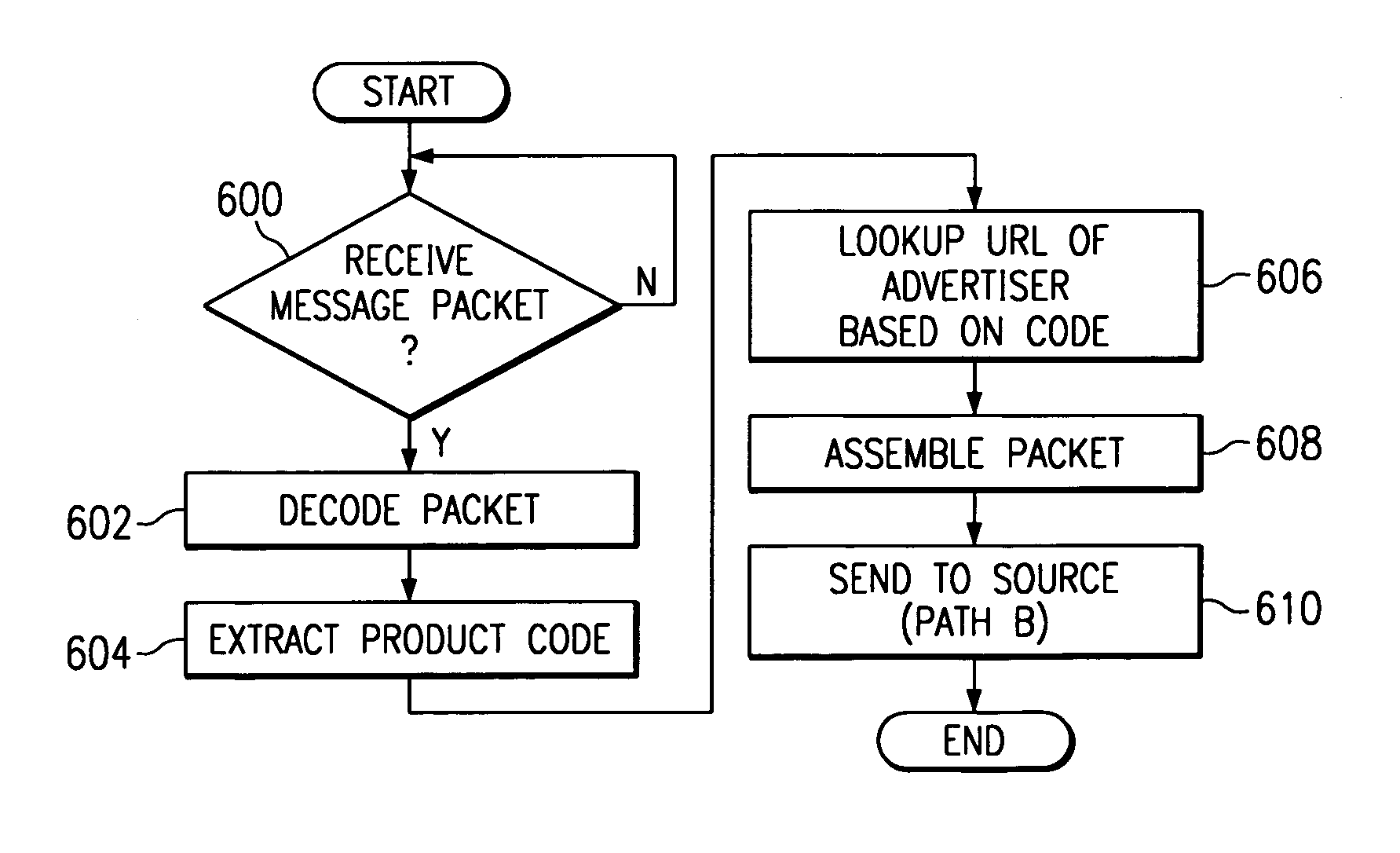

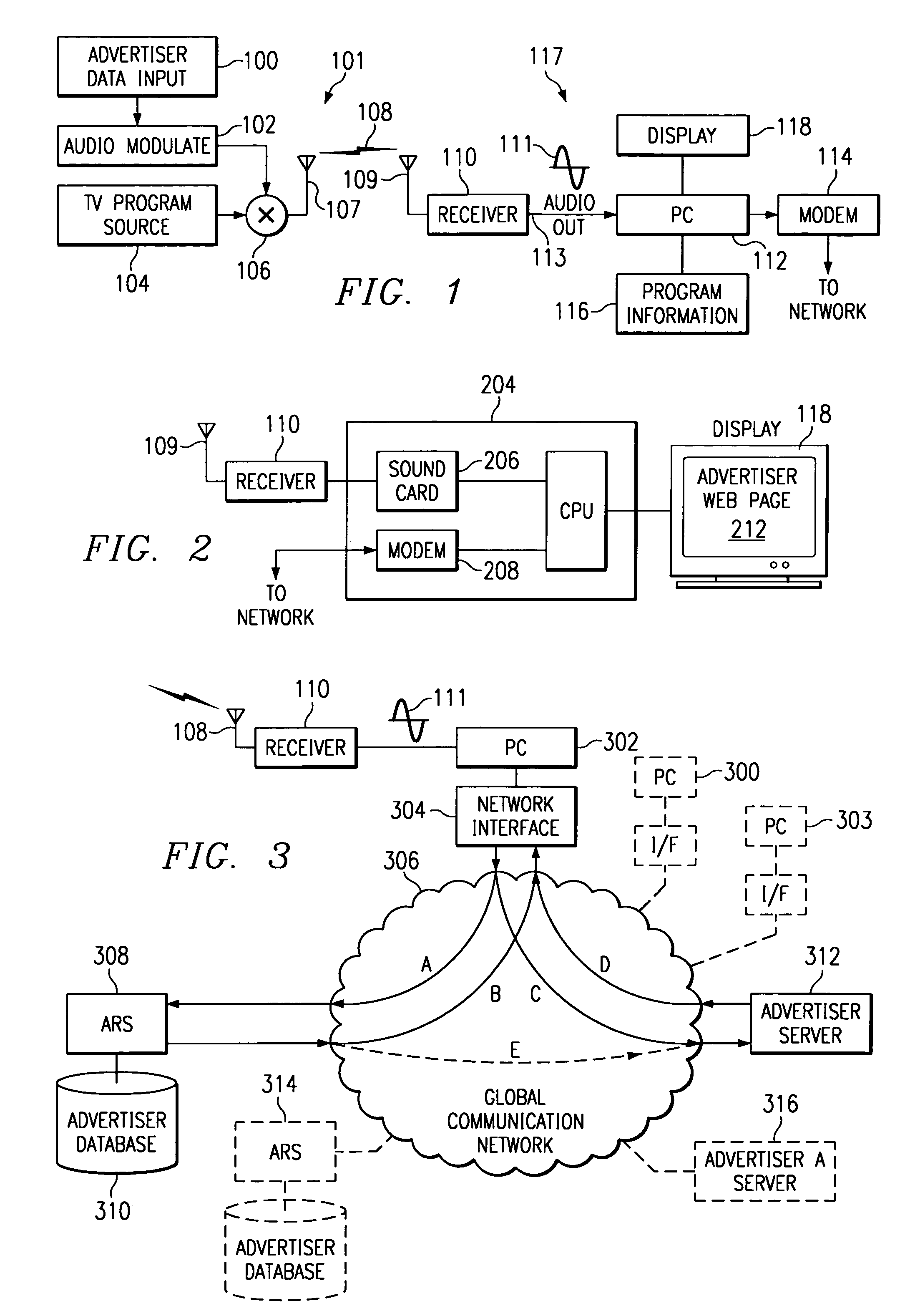

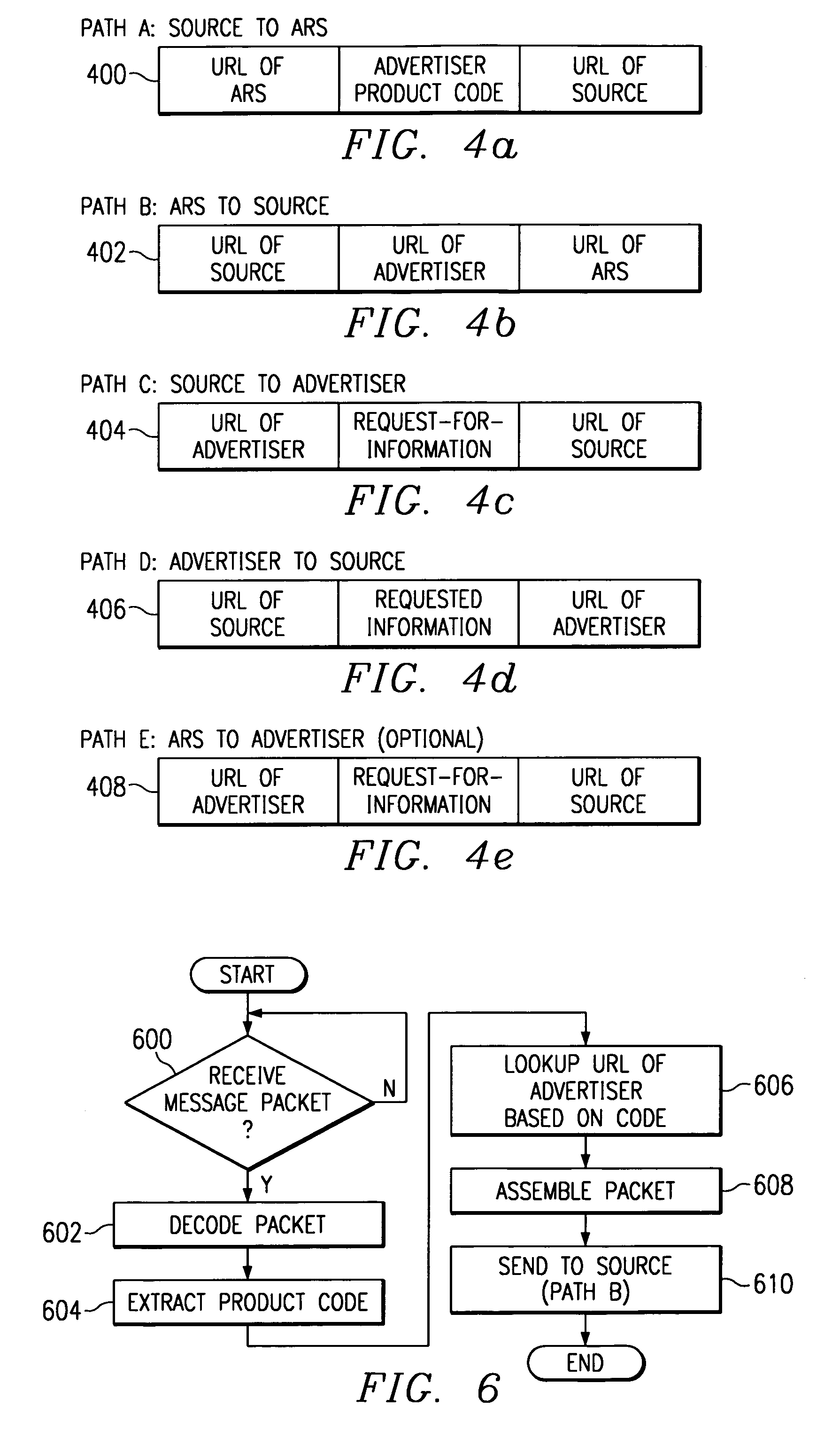

Accessing a vendor web site using personal account information retrieved from a credit card company web site

A method of accessing a vendor web site (3422) over a global communication packet-switched network (306) using personal account information of a credit card (3400) retrieved from a credit card company server (3300) on the network (306). At a user location disposed on the network, a machine-resolvable code (MRC) (3402) of the credit card (3400) of a user is read with a reading device (3410). Coded information is extracted from the MRC (3402). Routing information associated with the coded information is obtained, which routing information corresponds to the personal account information of the user stored on a credit card company server (3300) disposed on the network (306). The user location connects to the credit card company server (3300) across the network (306) in accordance with the routing information. The personal account information is returned from the credit card company server (3300) to the user location. The personal account information is then presented to the user at the user location. A hyperlink to a vendor web site (3422) is provided in the personal account information. Web site information of the vendor web site (3422) is displayed in response to the user selecting the hyperlink.

Owner:RPX CORP

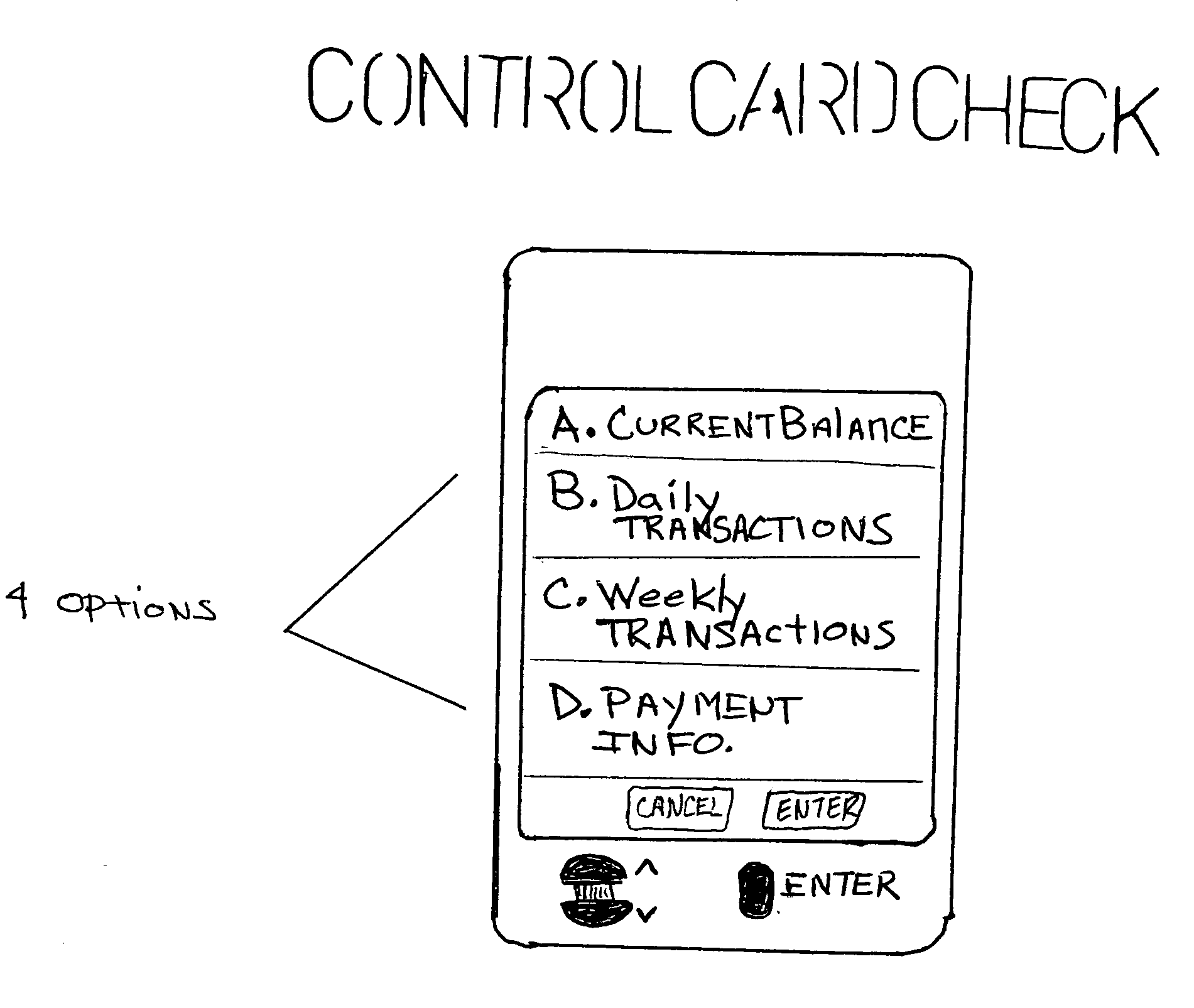

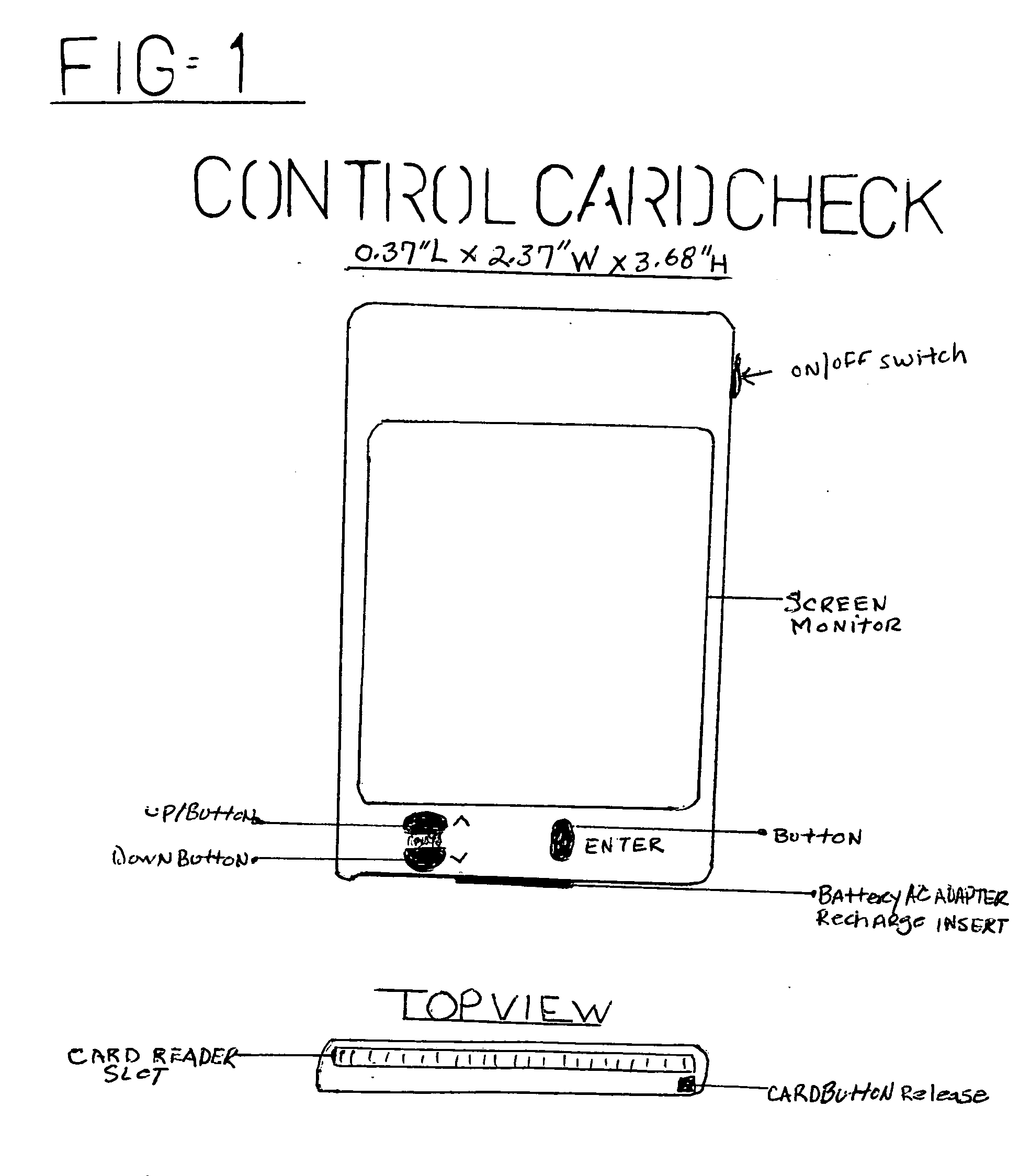

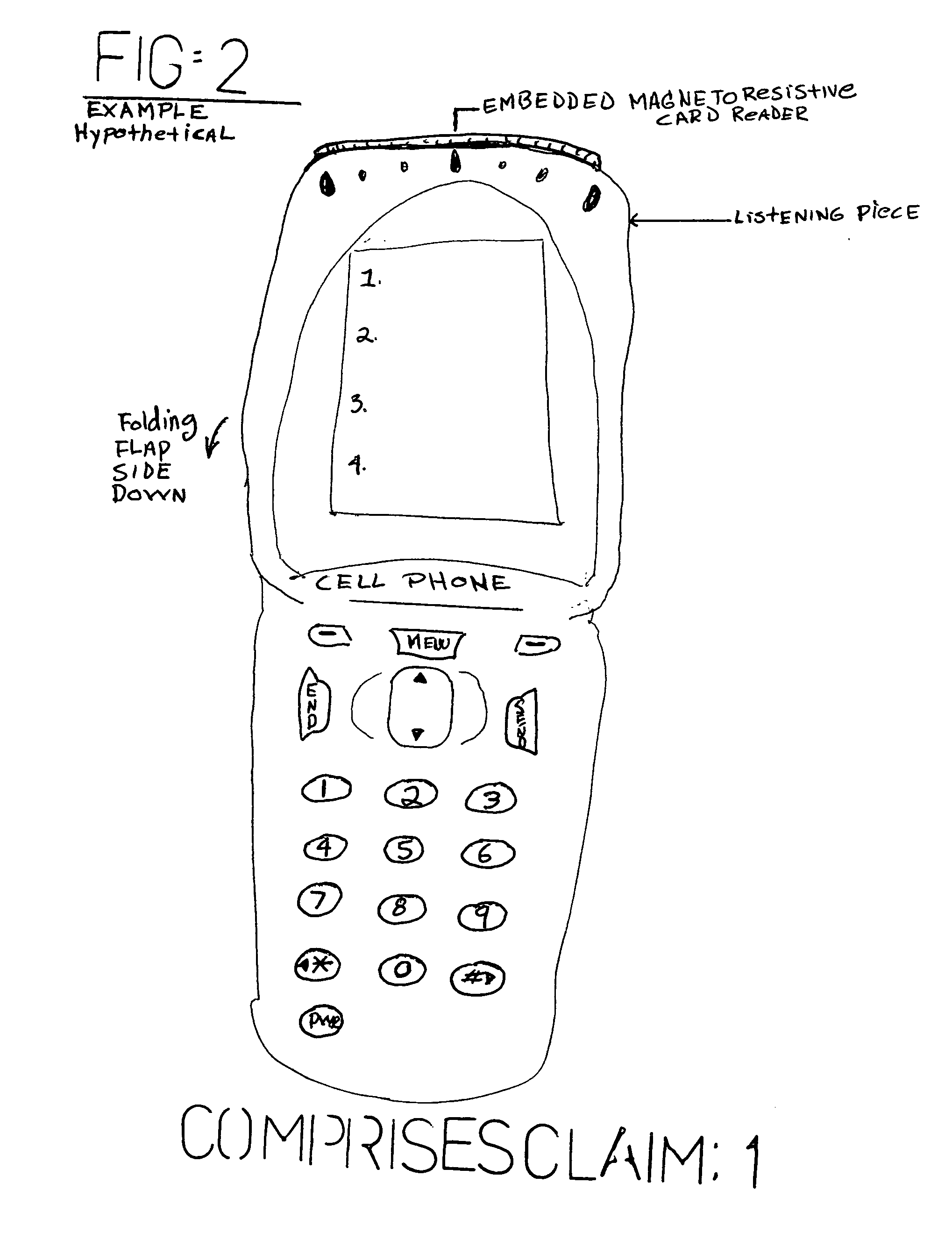

Control card check

CONTROL CARD CHECK is a pocket size system and a method for auditing personal accounts. It is an individual module that operates on a digital level. This invention is for bank account and credit card information inspecting only. This technology system provides access to your bank and credit card information instantaneously, without having to log onto the Internet, drive to your bank (ATM), or call a service bank agent. This system will allow you to check your current balance on any account card you own, excluding gas cards, retail cards, and phone cards, just by inserting the card into the card reader. The design of the pocket electro mechanism is slightly larger than your account card with a magnet strip-card reader embedded to the back of the instrument. In seconds, see your balance by entering your four-digit security pin number on the touch screen. On the menu screen you will have four options to choose from. 1. Current balance. 2. Daily transactions. 3. Weekly transactions. 4. Payment information and Due date. (Bank payment address & phone numbers). Ideal for any situation

Owner:FIGUERAS ILKA H +2

Accessing a vendor web site using personal account information retrieved from a credit card company web site

A method of accessing a vendor web site (3422) over a global communication packet-switched network (306) using personal account information of a credit card (3400) retrieved from a credit card company server (3300) on the network (306). At a user location disposed on the network, a machine-resolvable code (MRC) (3402) of the credit card (3400) of a user is read with a reading device (3410). Coded information is extracted from the MRC (3402). Routing information associated with the coded information is obtained, which routing information corresponds to the personal account information of the user stored on a credit card company server (3300) disposed on the network (306). The user location connects to the credit card company server (3300) across the network (306) in accordance with the routing information. The personal account information is returned from the credit card company server (3300) to the user location. The personal account information is then presented to the user at the user location. A hyperlink to a vendor web site (3422) is provided in the personal account information. Web site information of the vendor web site (3422) is displayed in response to the user selecting the hyperlink.

Owner:RPX CORP +1

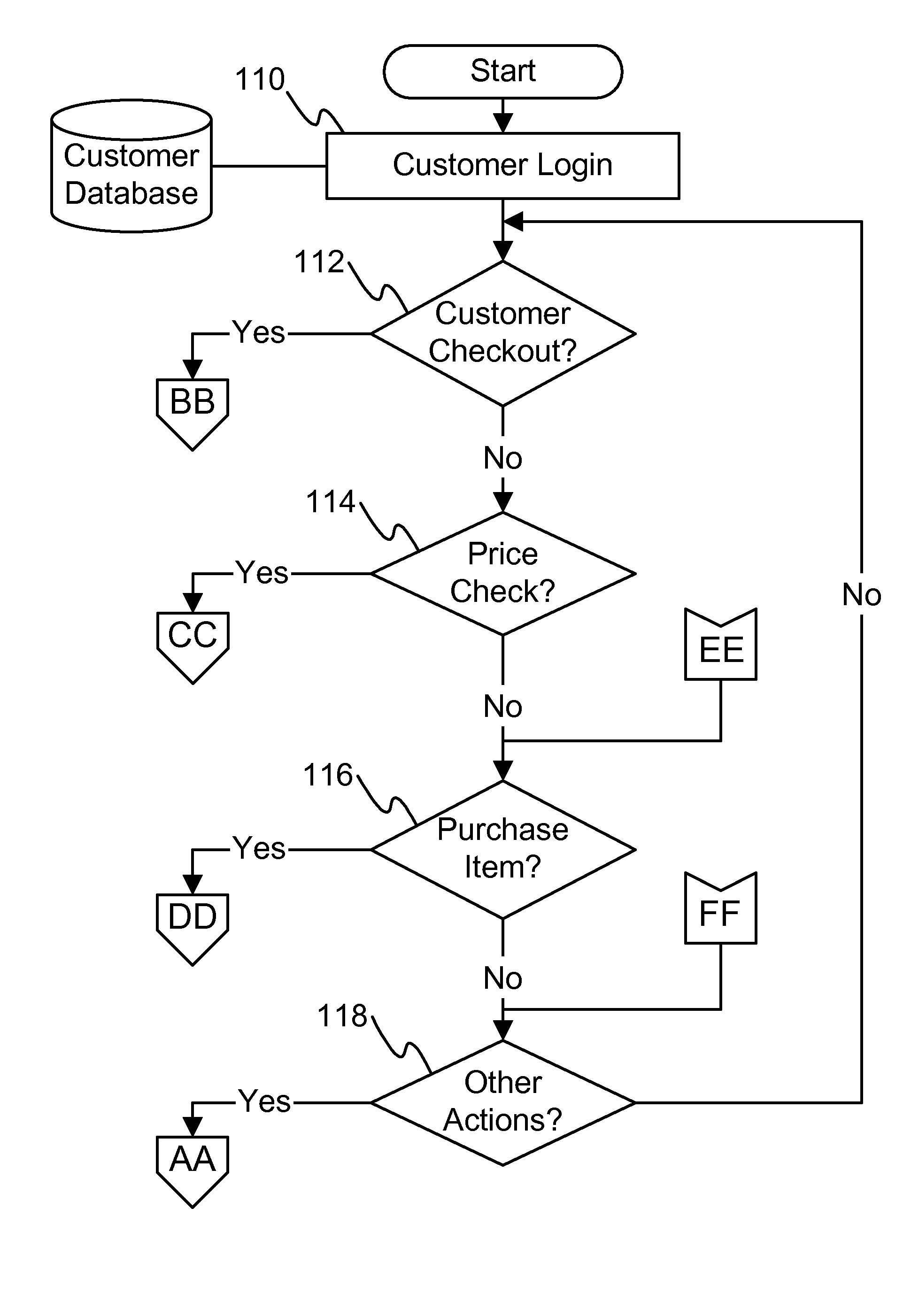

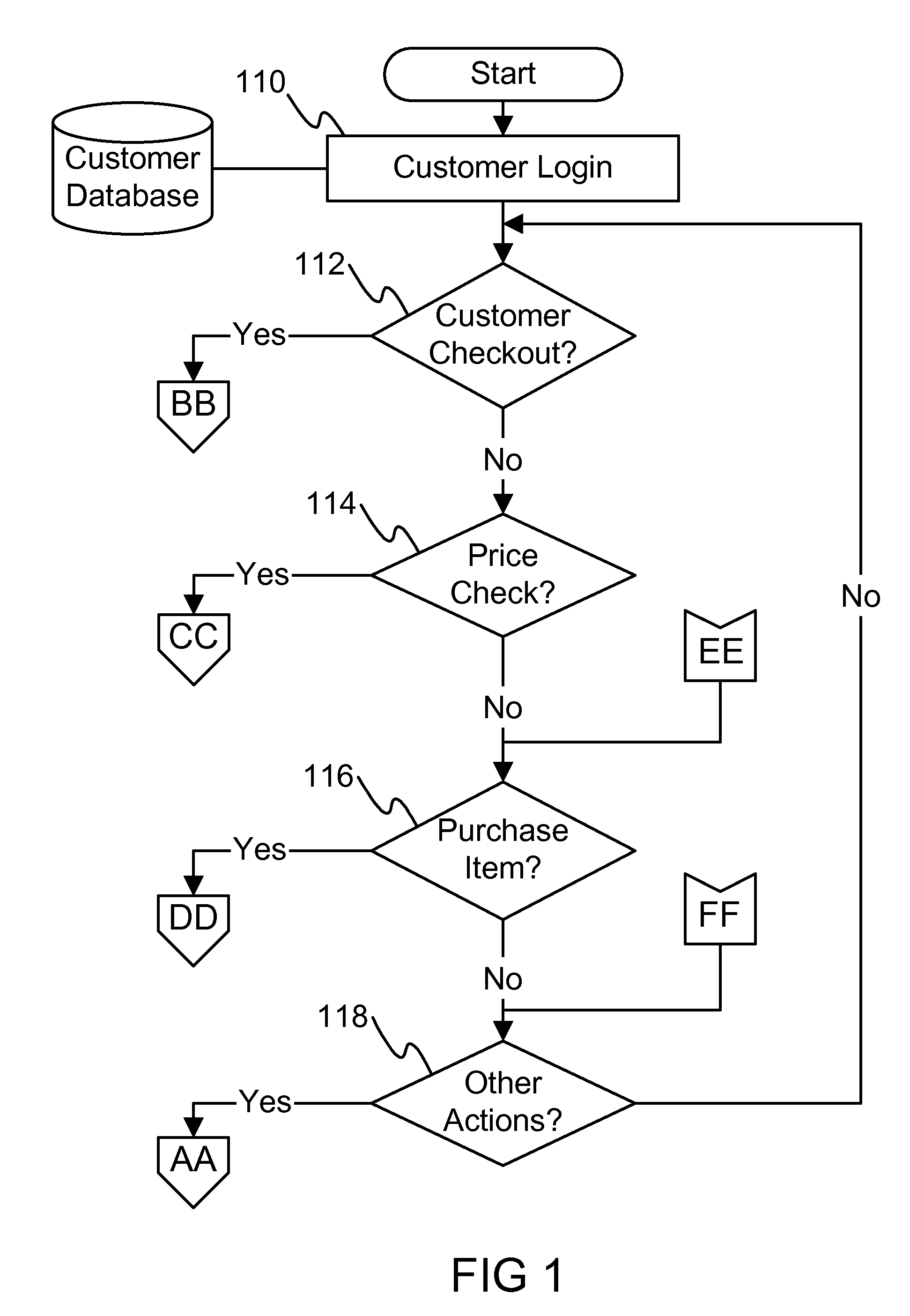

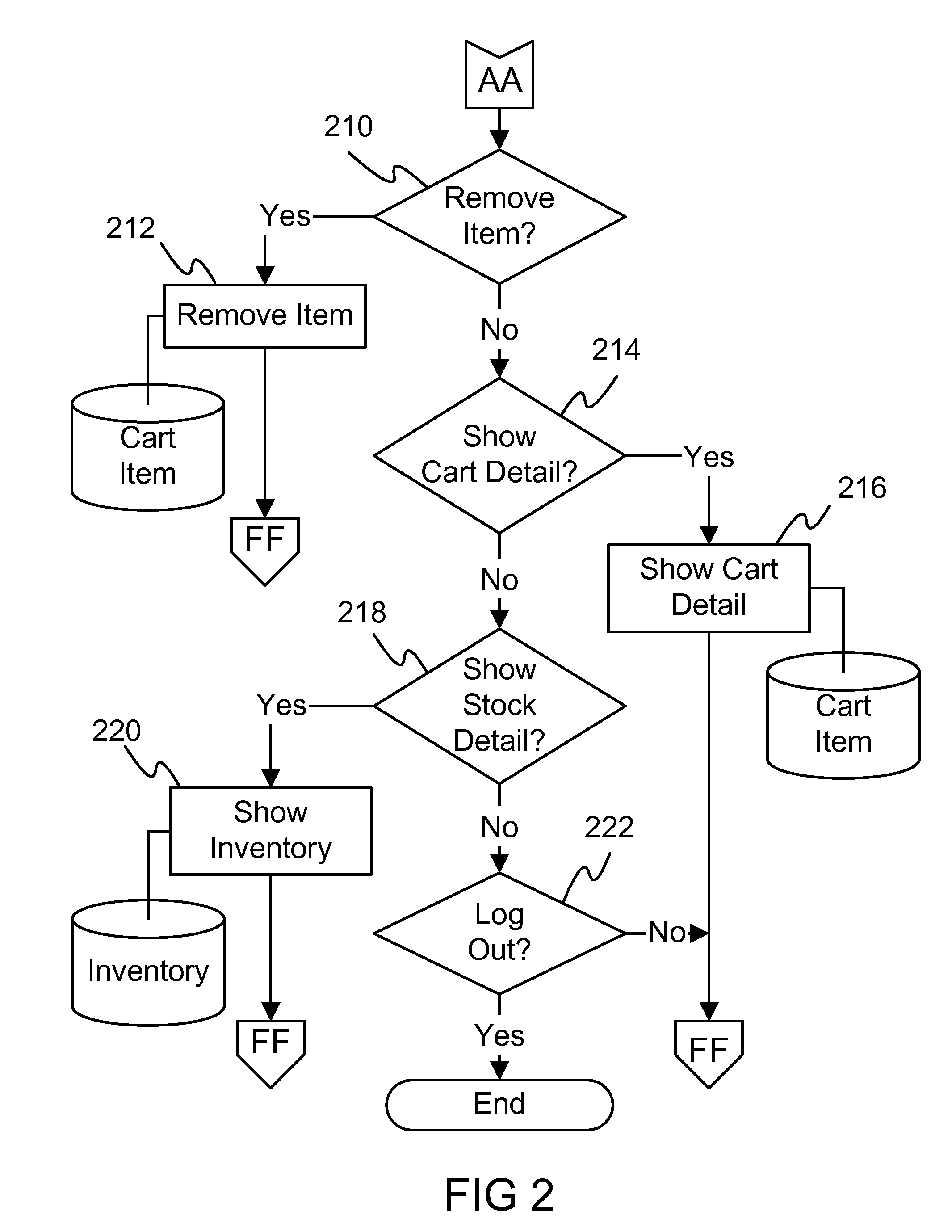

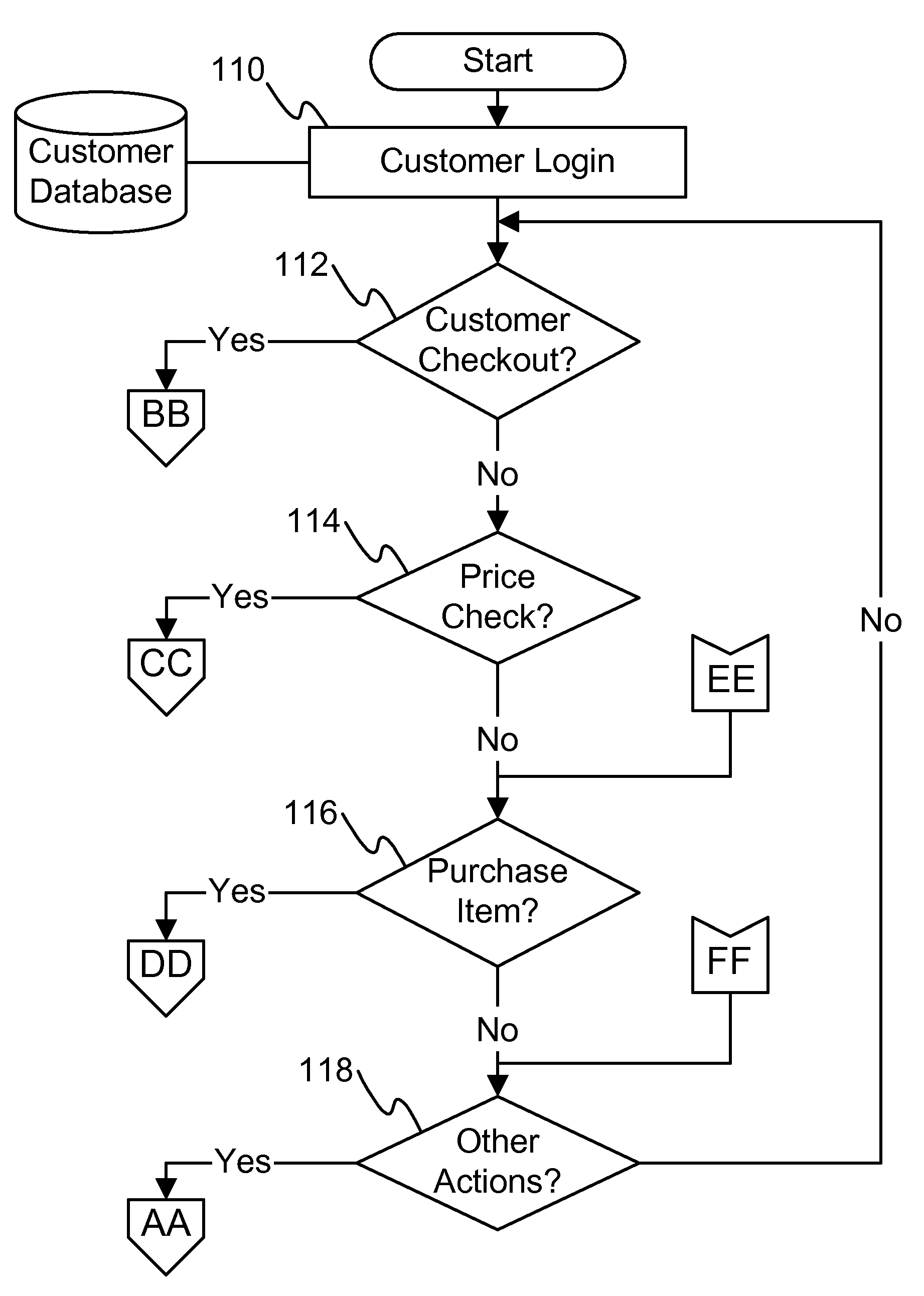

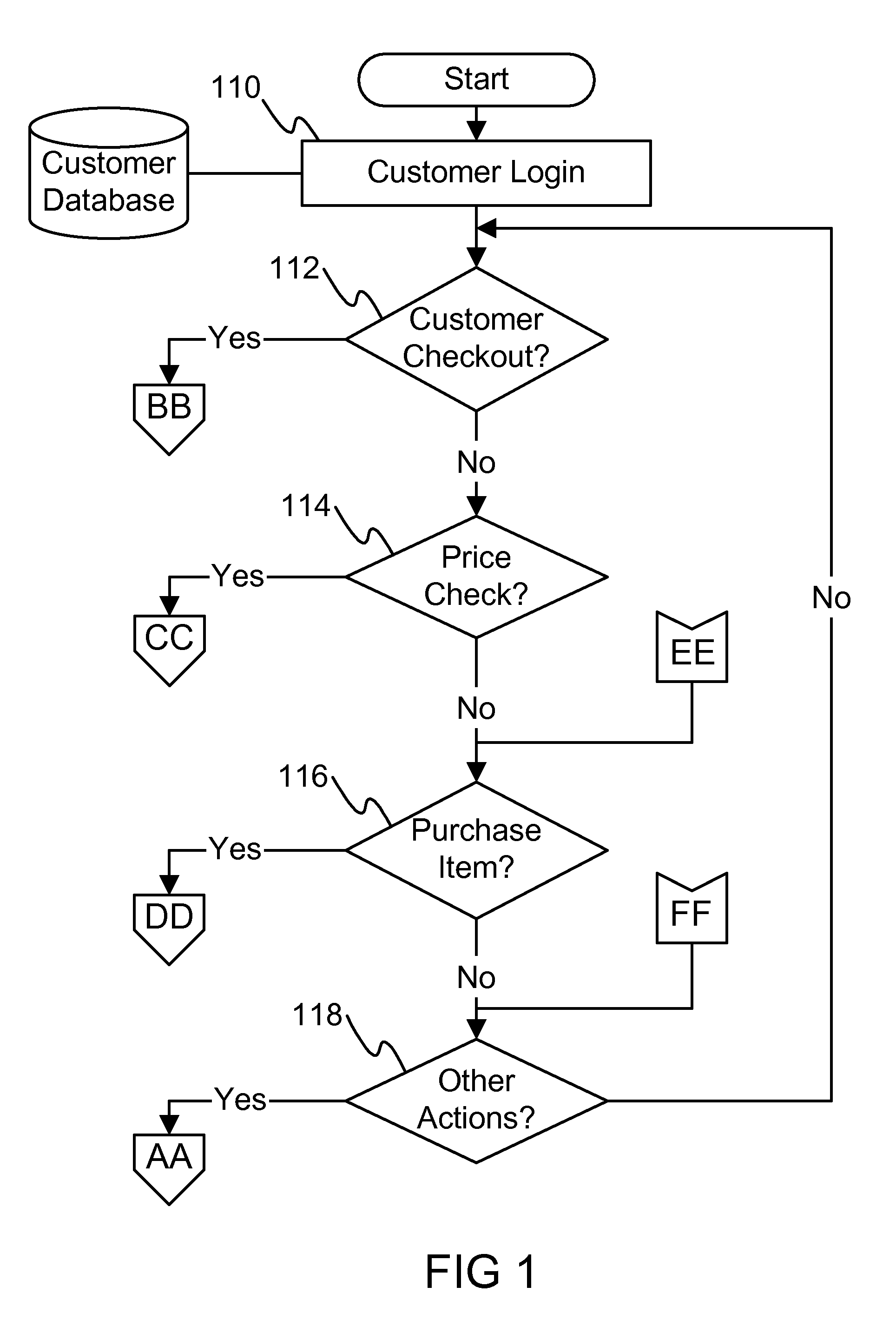

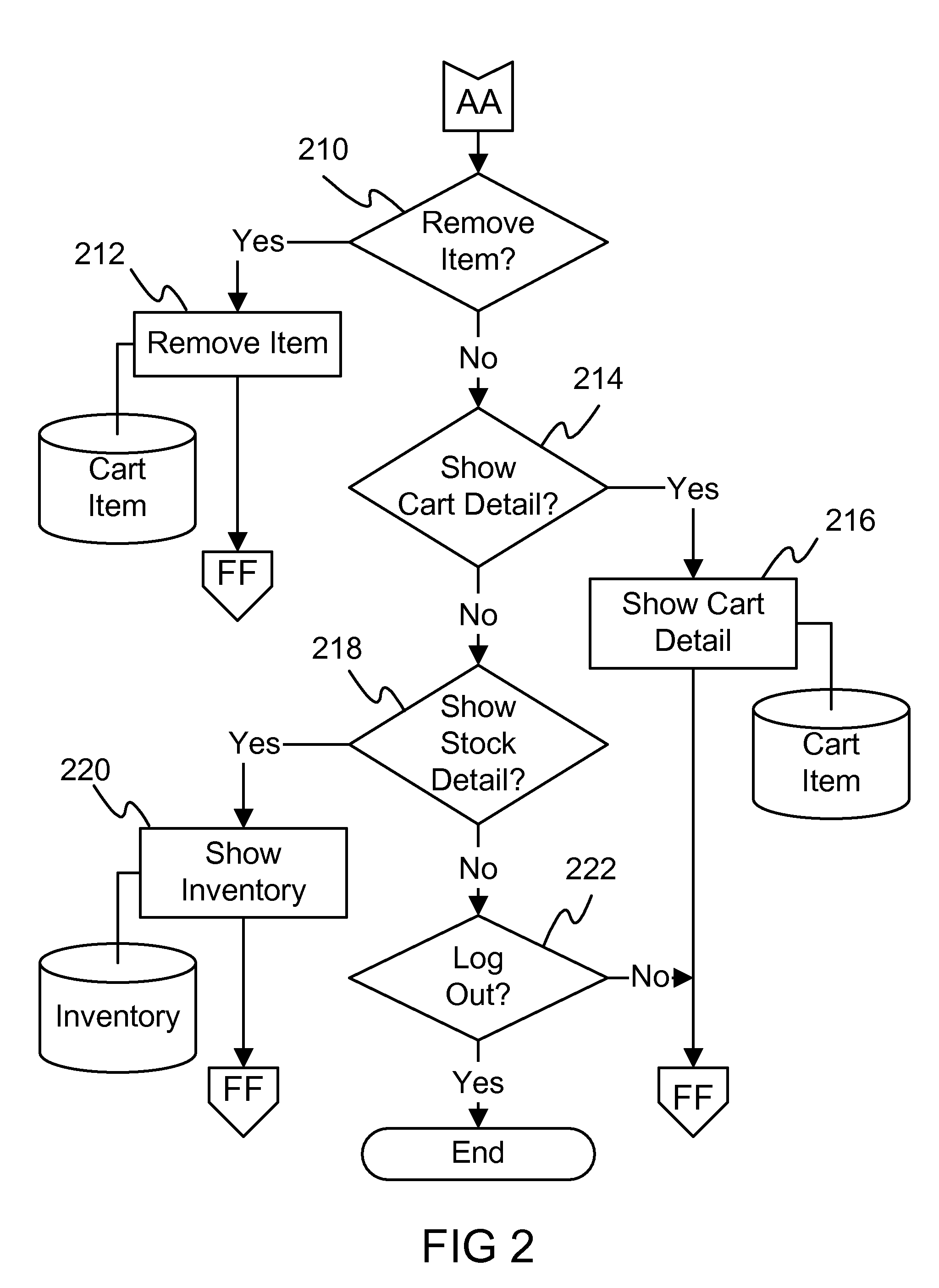

Method for shopping using wireless communication

This is a system to assist shoppers through a handheld wireless communications device which is Bluetooth-enabled (as an example) (a registered trademark), connected to a barcode reader to scan Universal Product Code (UPC) barcodes on items in the store. The shopper is required to login to the store's shopping system using this device once a personal account has created. While shopping, scan the items, view their prices and running total and finally complete the purchase. This system is also capable of (as an example) consolidating a personal shopping list created remotely through vendor's web site or stored on the personal communication device and the shopping cart to help and enhance the shopping experience.

Owner:IBM CORP

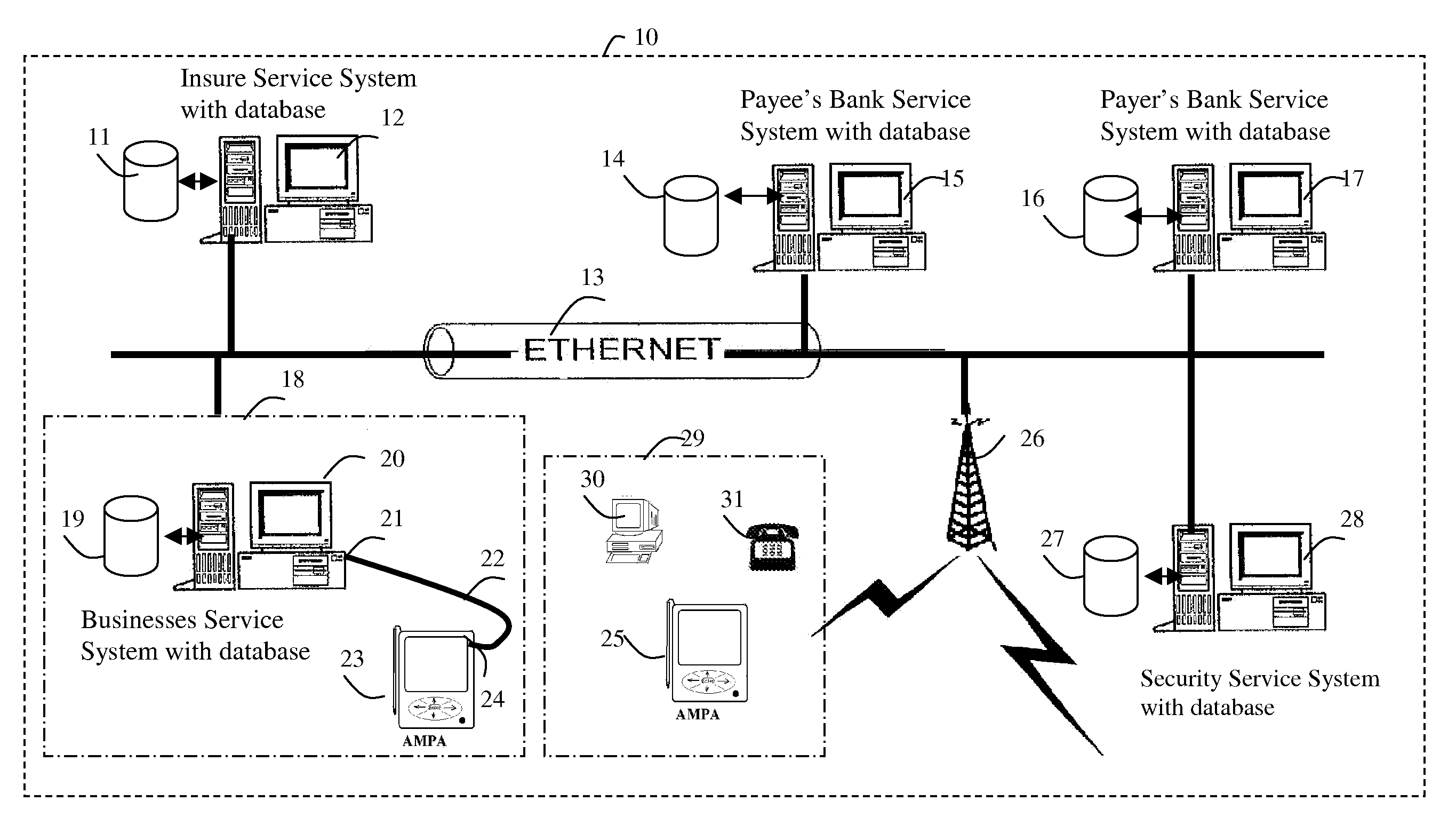

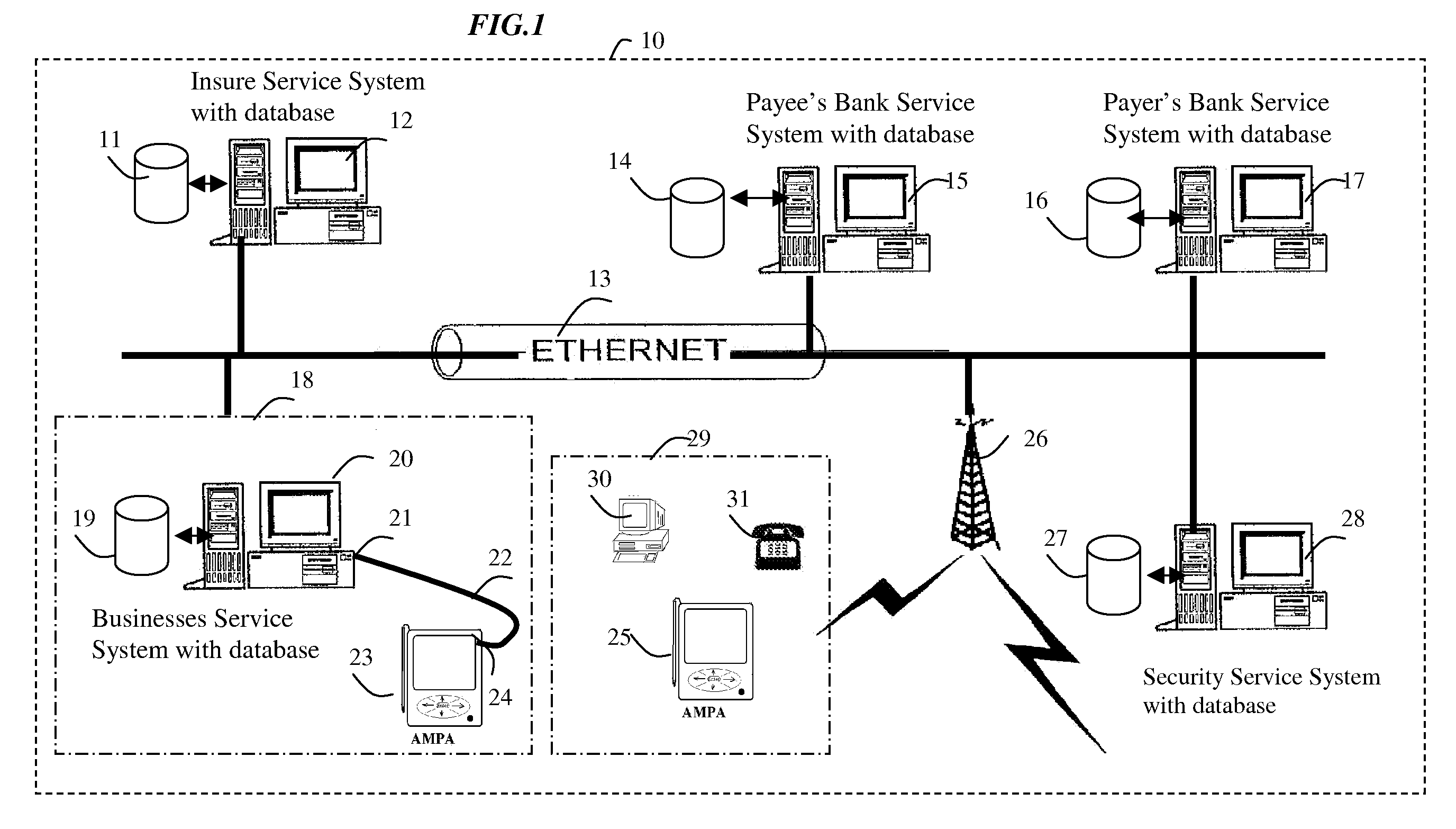

System and Method for defense ID theft attack security service system in marketing environment

InactiveUS20090018934A1Restrict abusingReduce and prevent occurrence of ID-theftComplete banking machinesFinanceAttackSystem maintenance

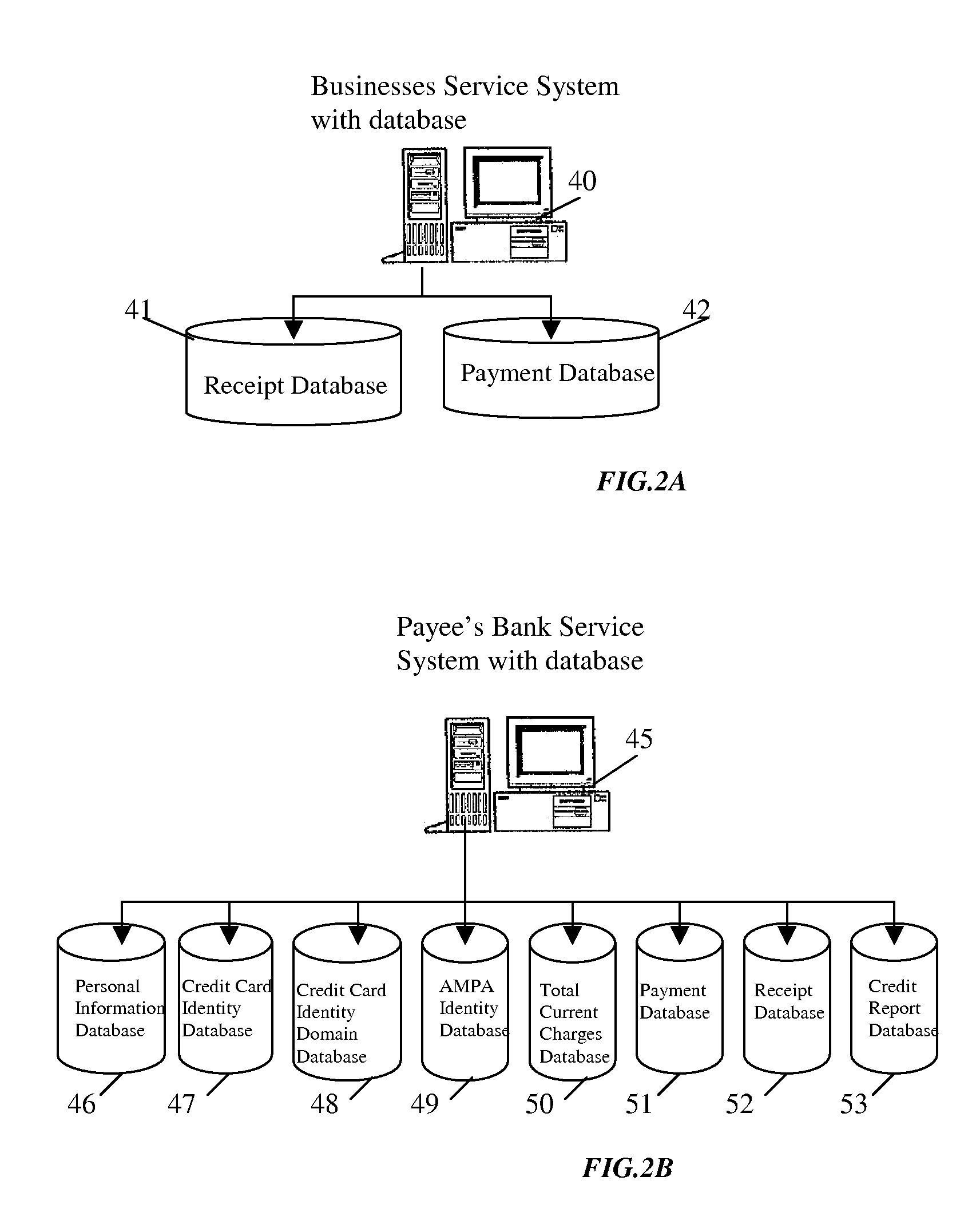

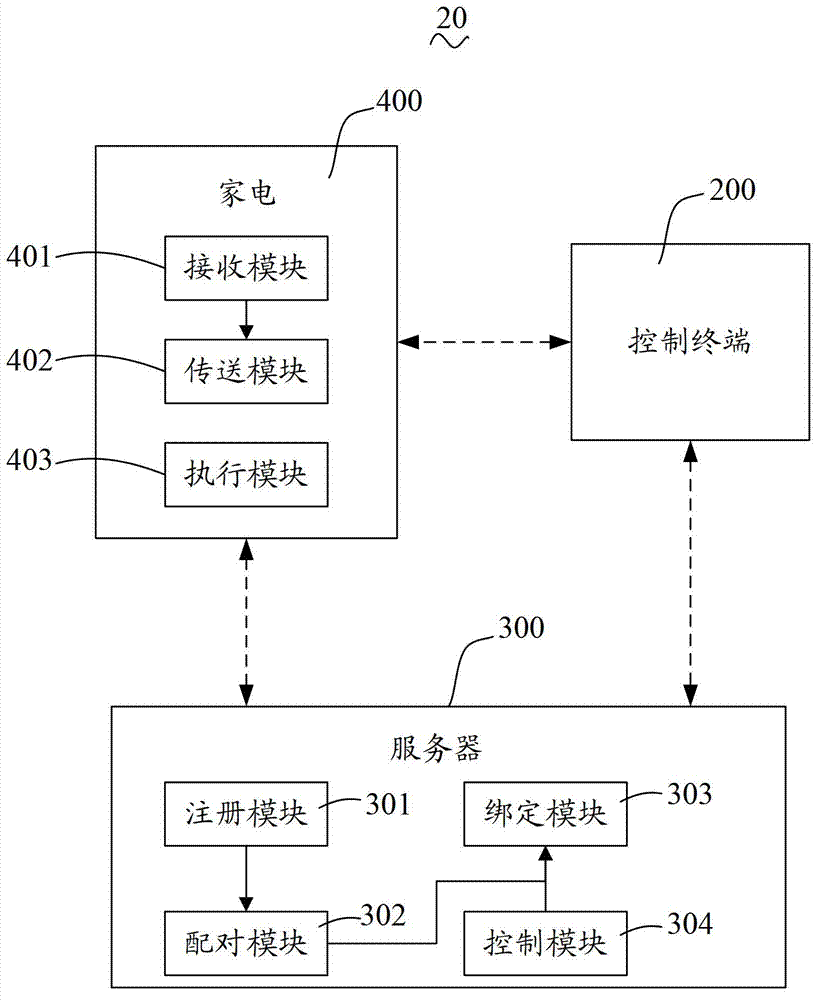

Each service system with a variety of databases in marketing environment maintains and audits purchasing transaction data to look for ID theft and transmits suspicion events to security service system which is attached to marketing environment. Security service system maintains status data and identifies information including biometric identity, portable device identity, and message to defeat ID-theft attacking. Identifying events is transmitted to service systems for derived information to reflect operation. Services systems include Insures Service Systems, Bank Service Systems, Business Service Systems, and Portable Devices under Security Service Systems monitoring in marketing environment. And also a portable device with a local CPU, memory, I / O interface, wireless network and a host interface provides user for purchasing transaction with merchant. A portable device retains pertinent purchasing transaction data and establishes personal account in memory to aid person analyzes with the collected data and identify potential ID theft attacks in the marketing environment.

Owner:PENG CHAORONG +1

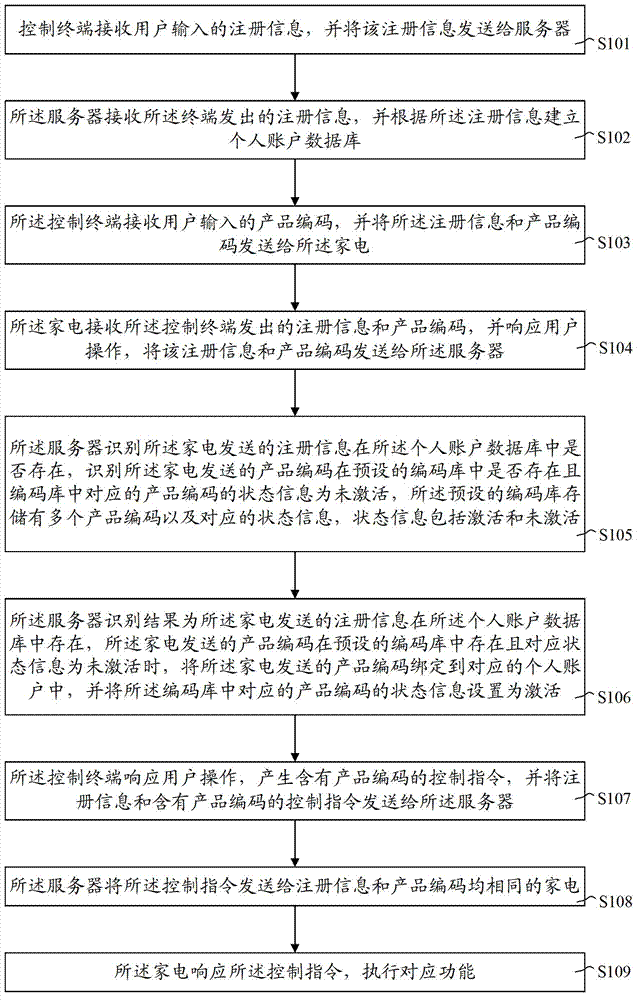

Household appliance control method, and household appliance and server adopting same

ActiveCN103078904AReduce the possibilityImprove reliabilityTransmissionSpecial data processing applicationsSoftware engineeringComputer terminal

The invention discloses a household appliance control method, comprising the steps that a control terminal transmits registration information to a server; the server creates a personal account database according to the registration information; the control terminal transmits the registration information and a product code to a household appliance; the household appliance transmits the registration information and the product code to the server; the server identifies whether the registration information exists in the personal account database or not and identifies whether the product code exists in a preset code base or not and the corresponding state information is inactivated or not; and if the server identifies that the registration information exists, the product code exists and the corresponding state information is inactivated, the product code is bound in the corresponding personal account, and the state information of the product code is set to be activated. The invention also provides the corresponding household appliance and the server. According to the household appliance control method, the control terminal is controlled through the binding of the registration information and the product code, and the transmission of a control instruction between the server and the household appliance is higher in reliability as the probability that the registration information and the product code are known by other people is very small.

Owner:TCL HOME APPLIANCES (HEFEI) CO LTD

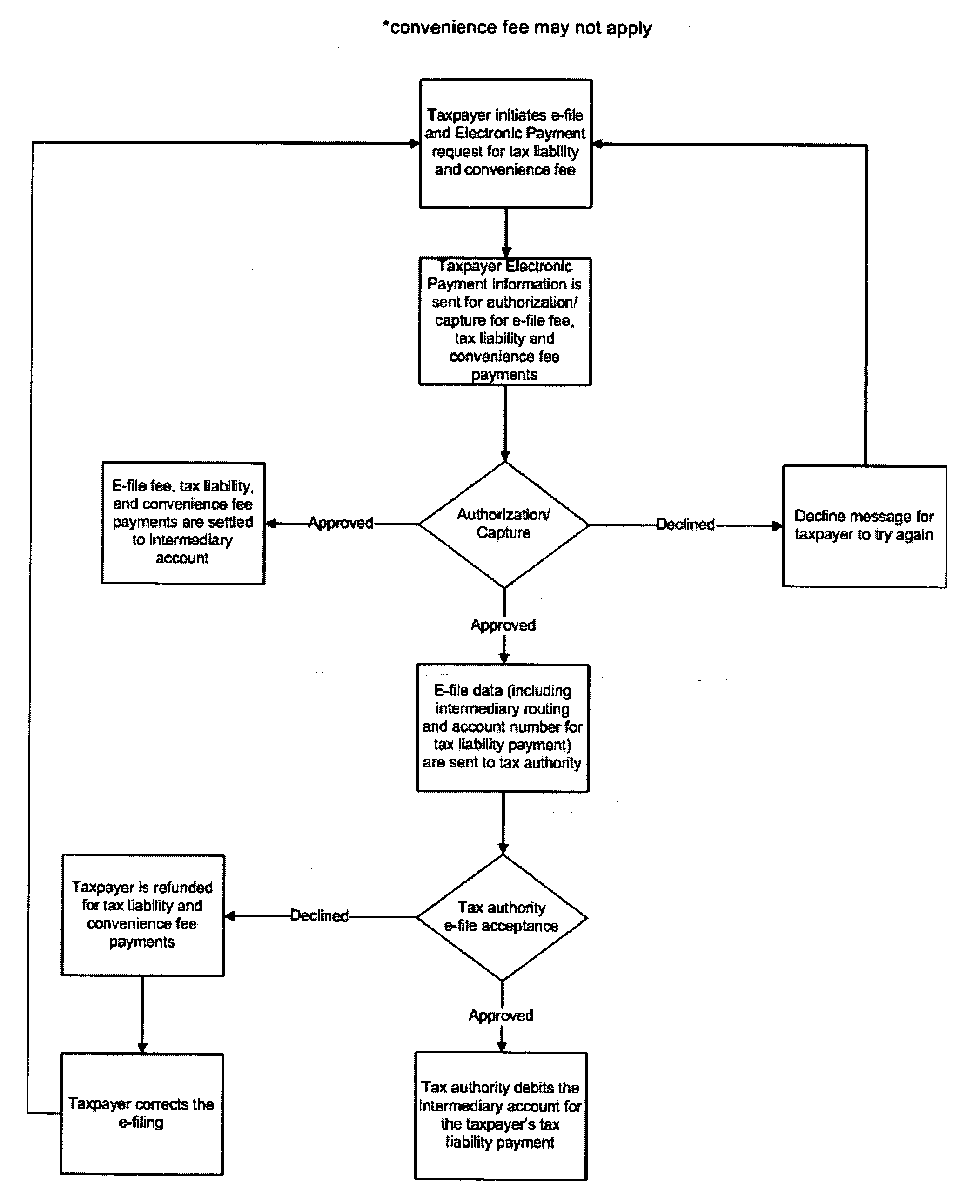

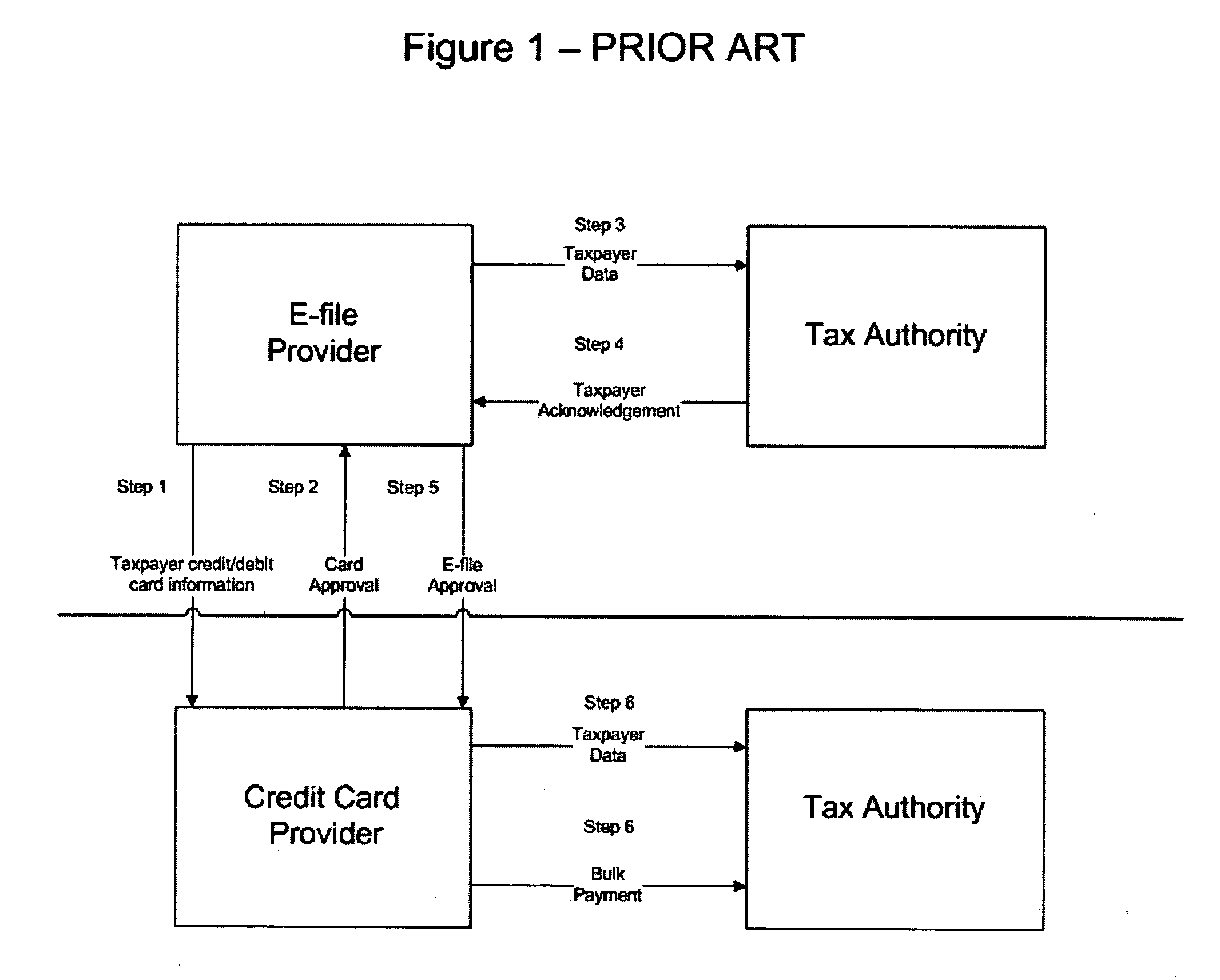

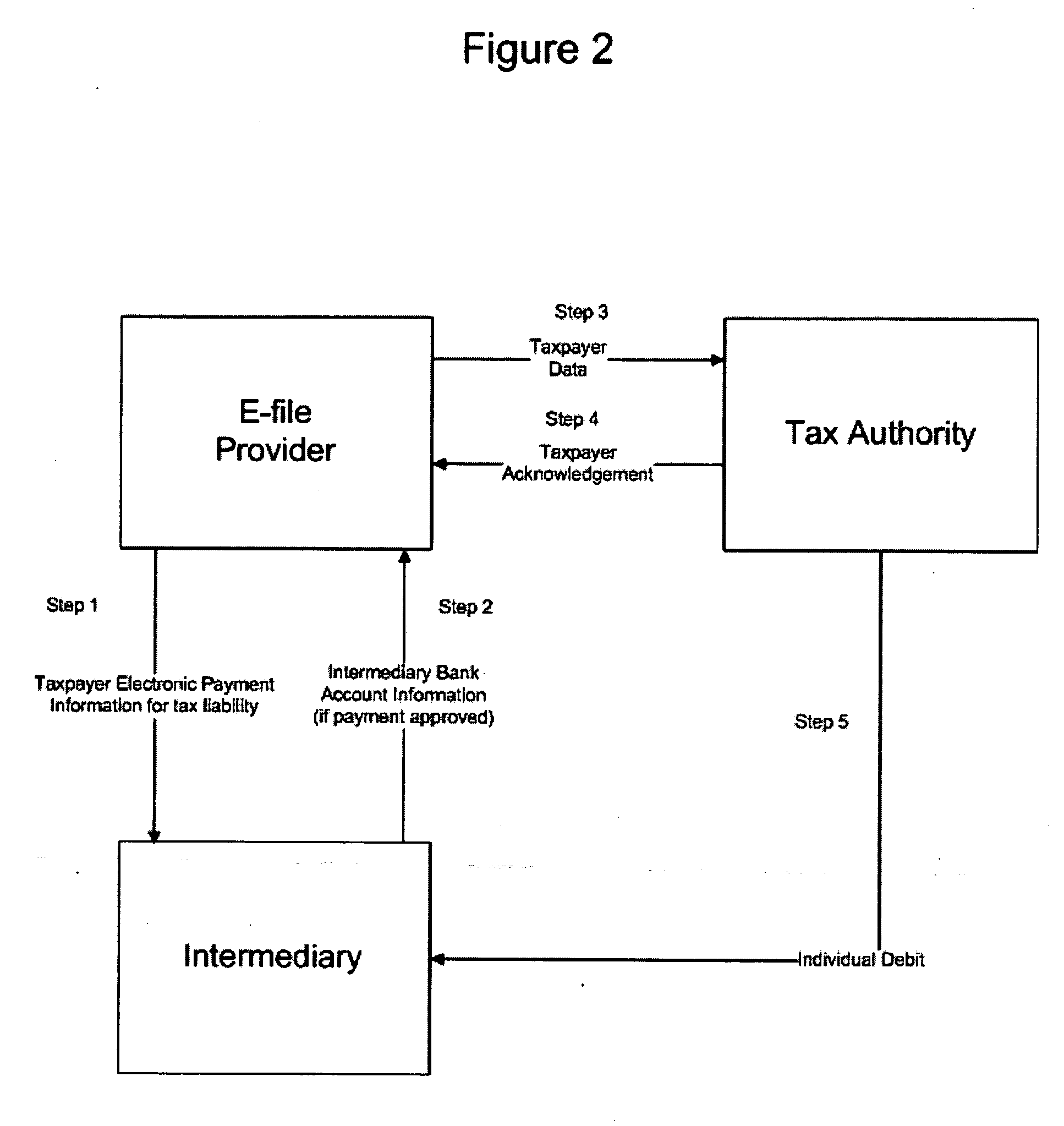

Methods for electronic payments using a third party facilitator

InactiveUS20090319427A1Simplify and enable processing of paymentConvenient transactionFinancePayment schemes/modelsThird partyComputer network

Methods for processing payments electronically over a network-based system wherein a third party or intermediary simplifies payment transactions by making them on behalf of individuals to the end payment recipient without providing individual account information as the basis for the payment.

Owner:VALUE PAYMENT SYST

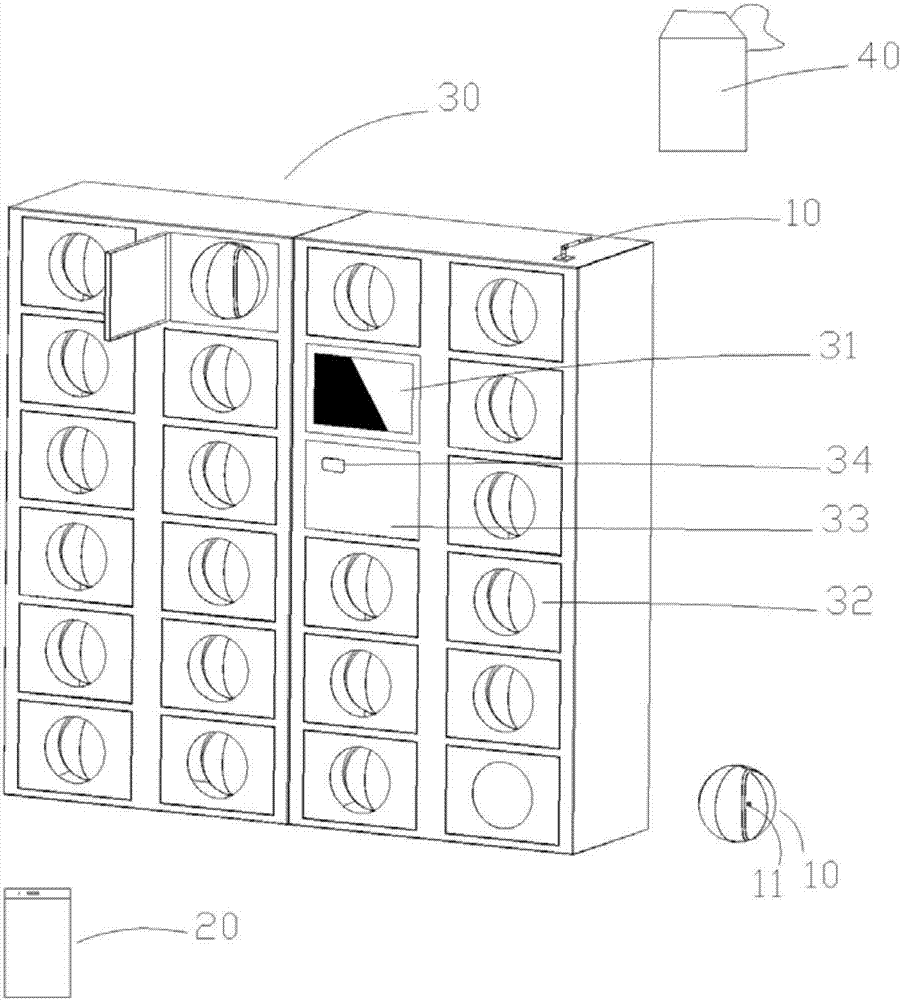

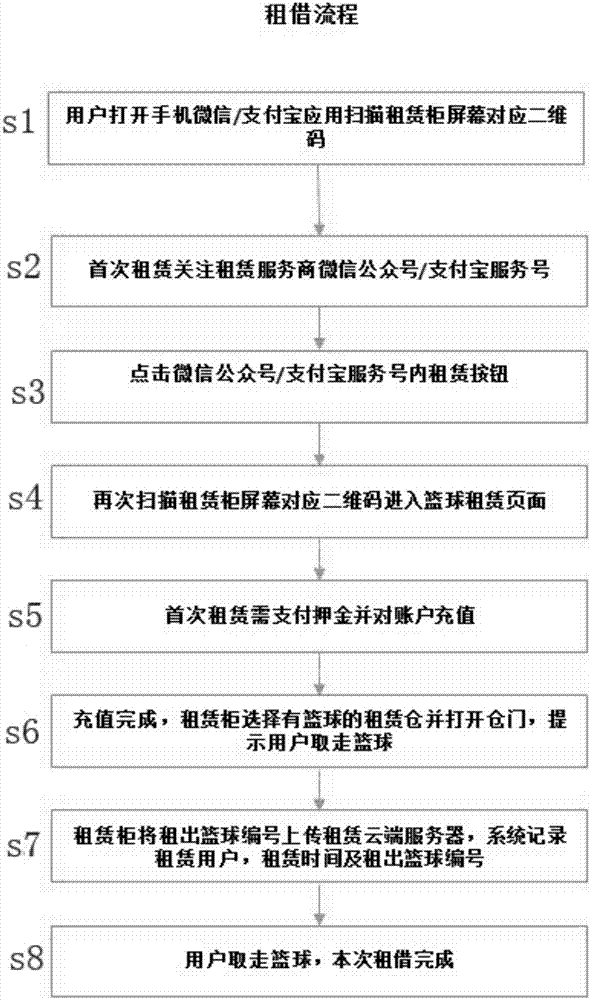

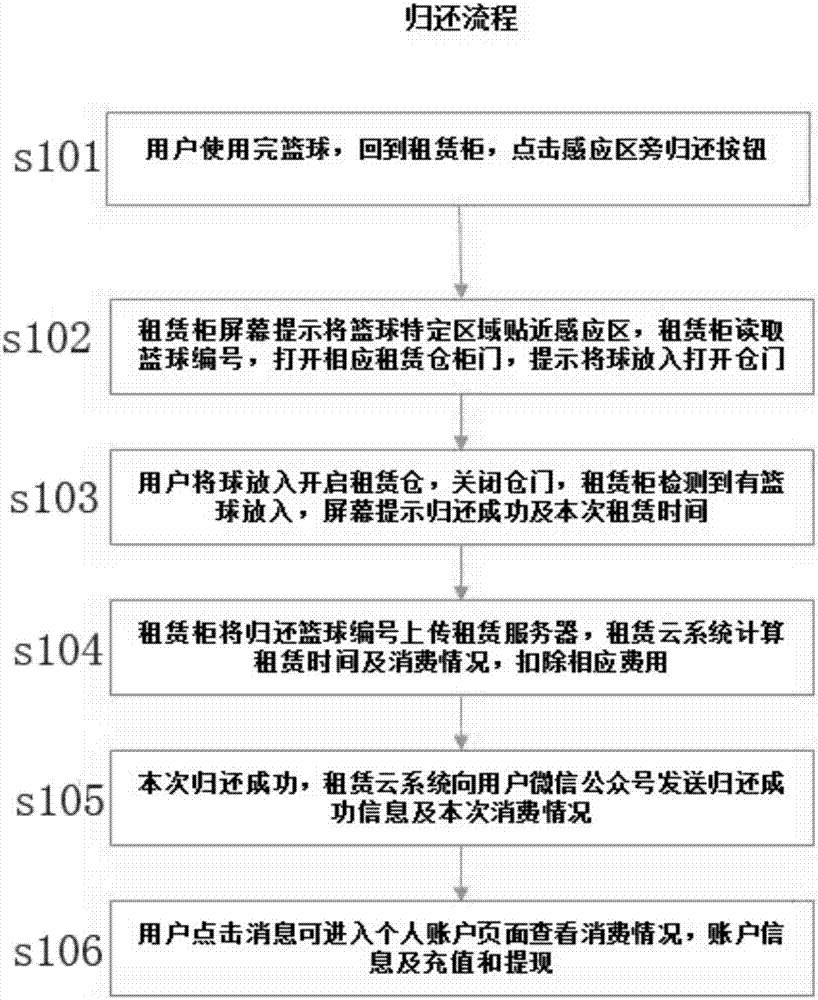

System and method for renting basketball through smart phone

PendingCN106991764AEasy to useSolve unmanagementSubstation equipmentApparatus for meter-controlled dispensingThe InternetMaintenance management

The invention relates to a method and system for renting a basketball through a smart phone. The method comprises renting processes and returning processes. By designing a renting application and equipment maintenance management system for a cloud server and a basketball renting cabinet connected with the internet, a special wireless induction electronic tag chip basketball is added in a matched mode, on the basis of a smart phone application, and the convenient and fast basketball renting service can be provided for a basketball fan; by adopting a smart phone application / wechat official account / alipay service number, a two-dimensional code of a renting cabinet is scanned for basketball renting and returning, related information is uploaded to a cloud server, the renting application system of the cloud server is used for calculating the renting time, the consumption condition and cost, and consumption account settling and personal account management are achieved.

Owner:高雄飞

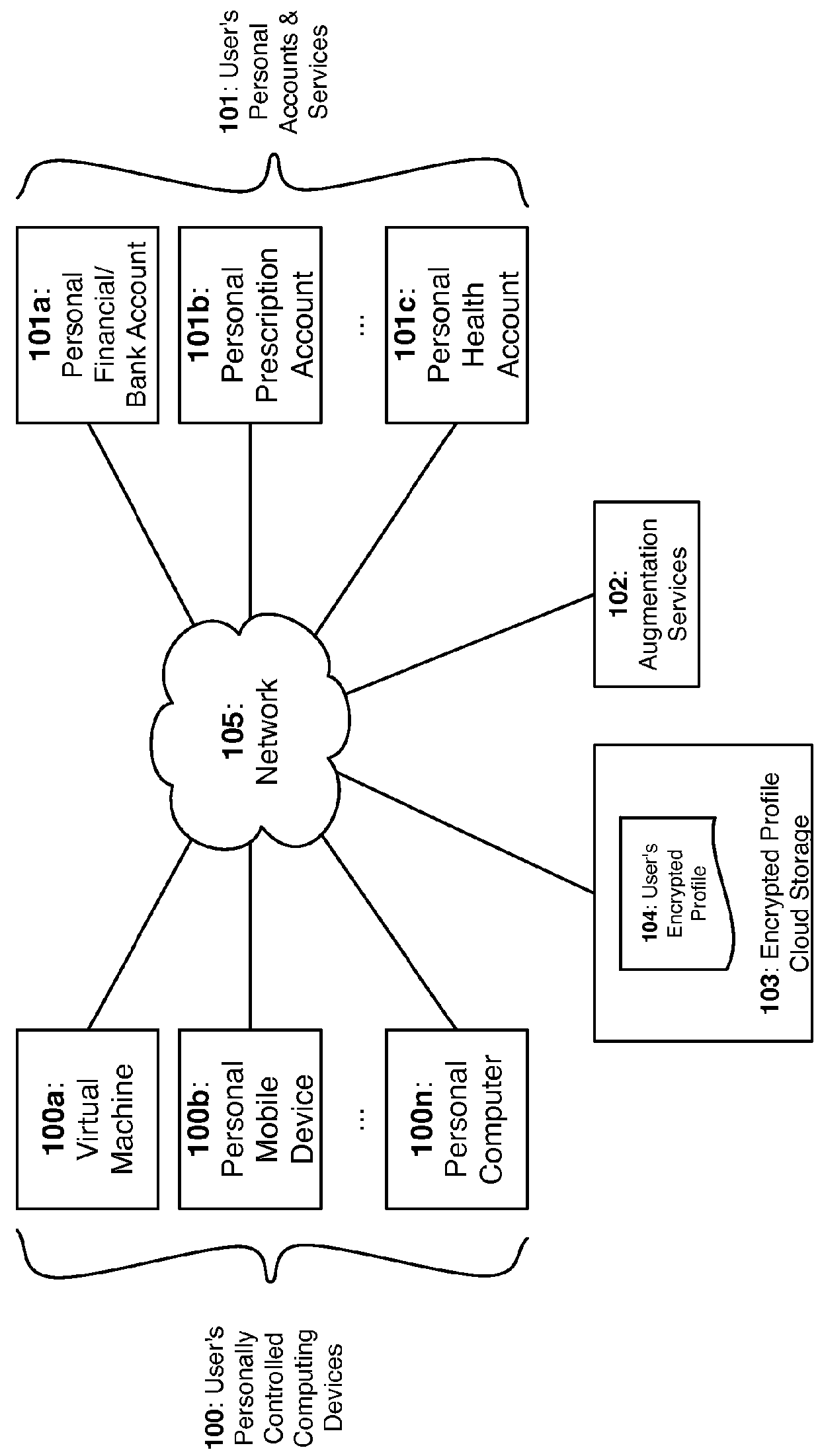

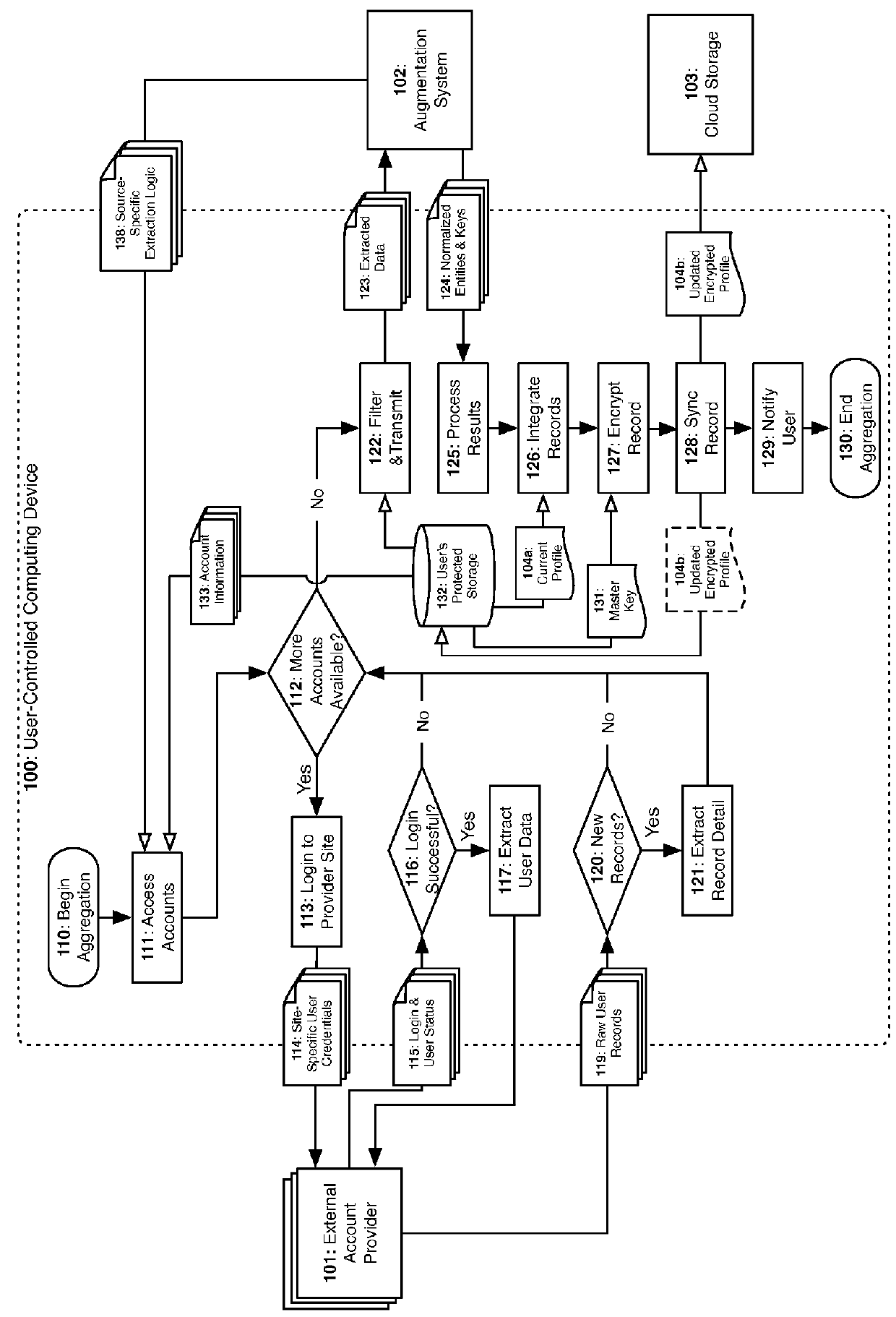

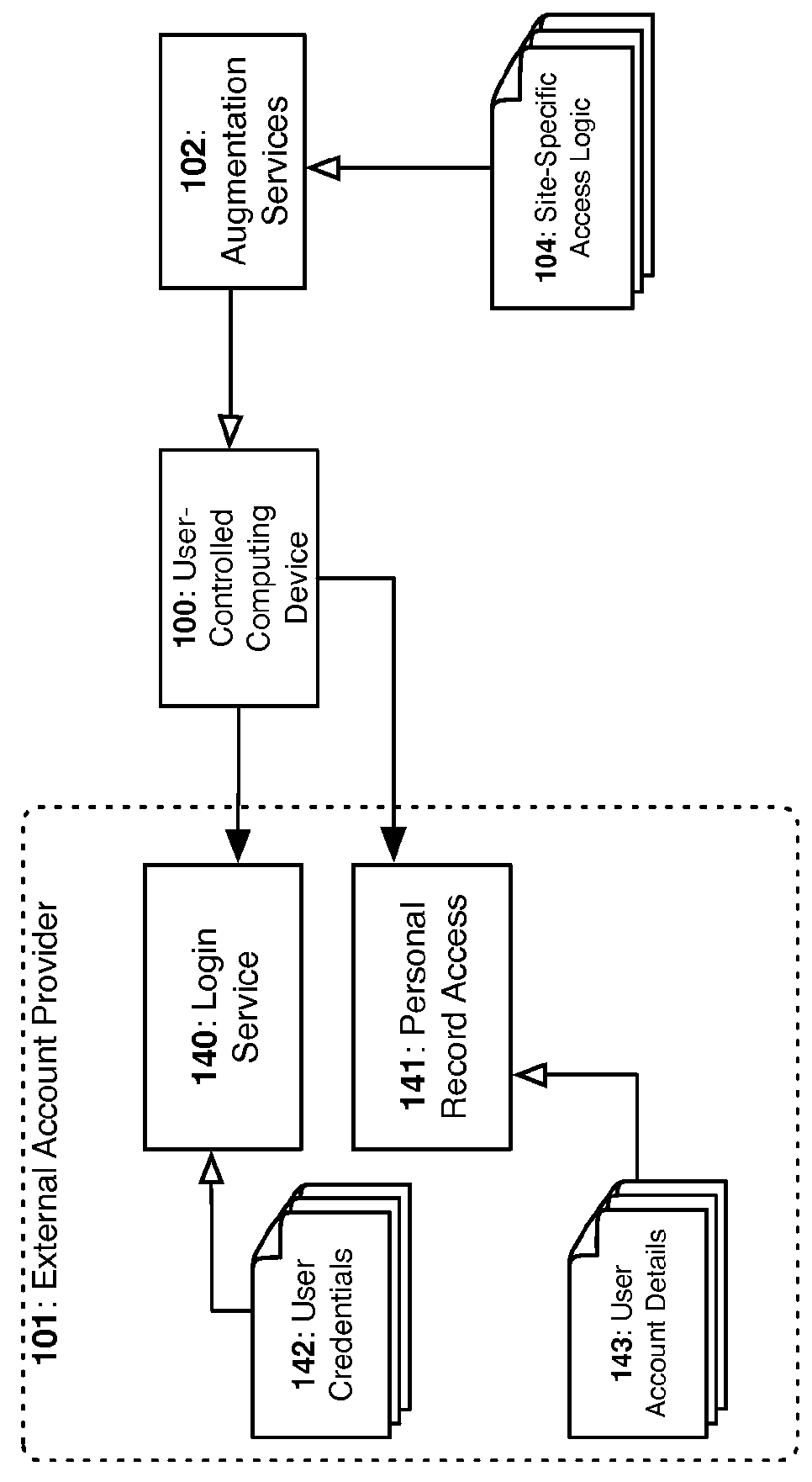

Decentralized Systems and Methods to Securely Aggregate Unstructured Personal Data on User Controlled Devices

InactiveUS20160034713A1Simplify key managementImprove securityDigital data processing detailsUser identity/authority verificationInternet privacyPrivacy preserving

A privacy-preserving decentralized computer-implemented system and method for securely aggregating an individual's personal data by extracting, redacting, normalizing, and linking data from a plurality of the individual's personal accounts and services.

Owner:APOTHESOURCE

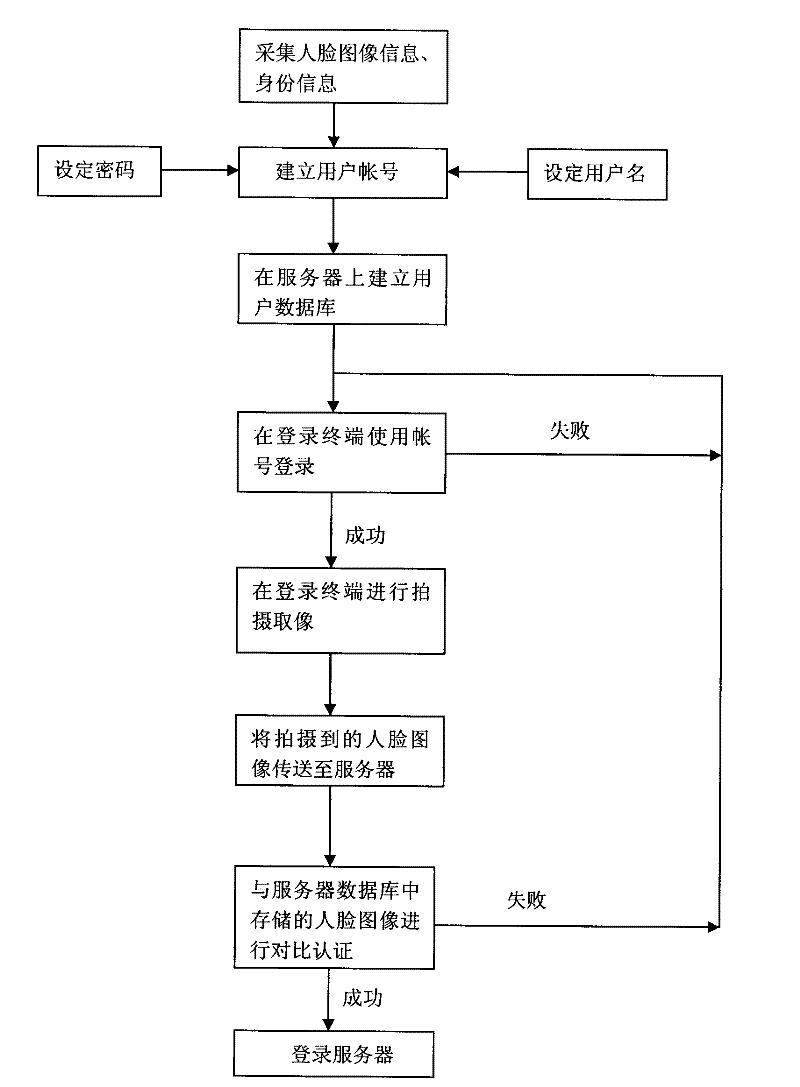

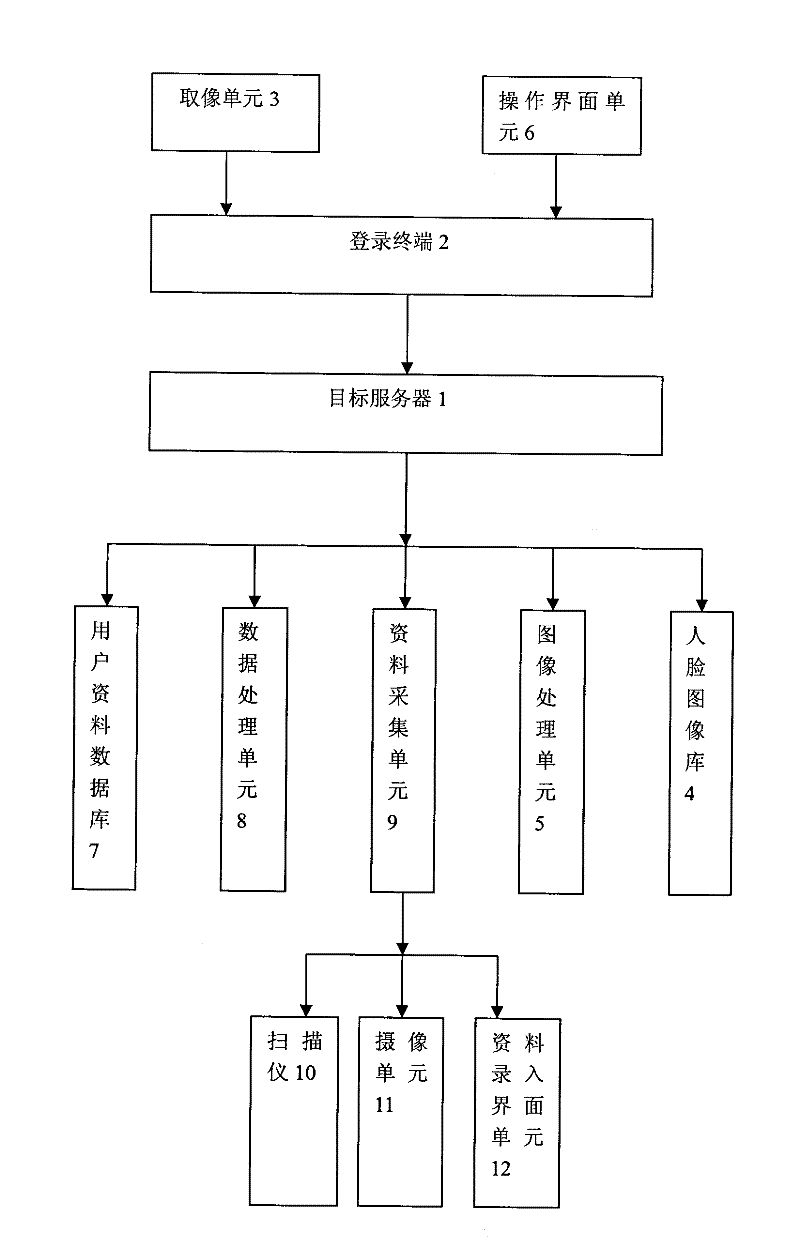

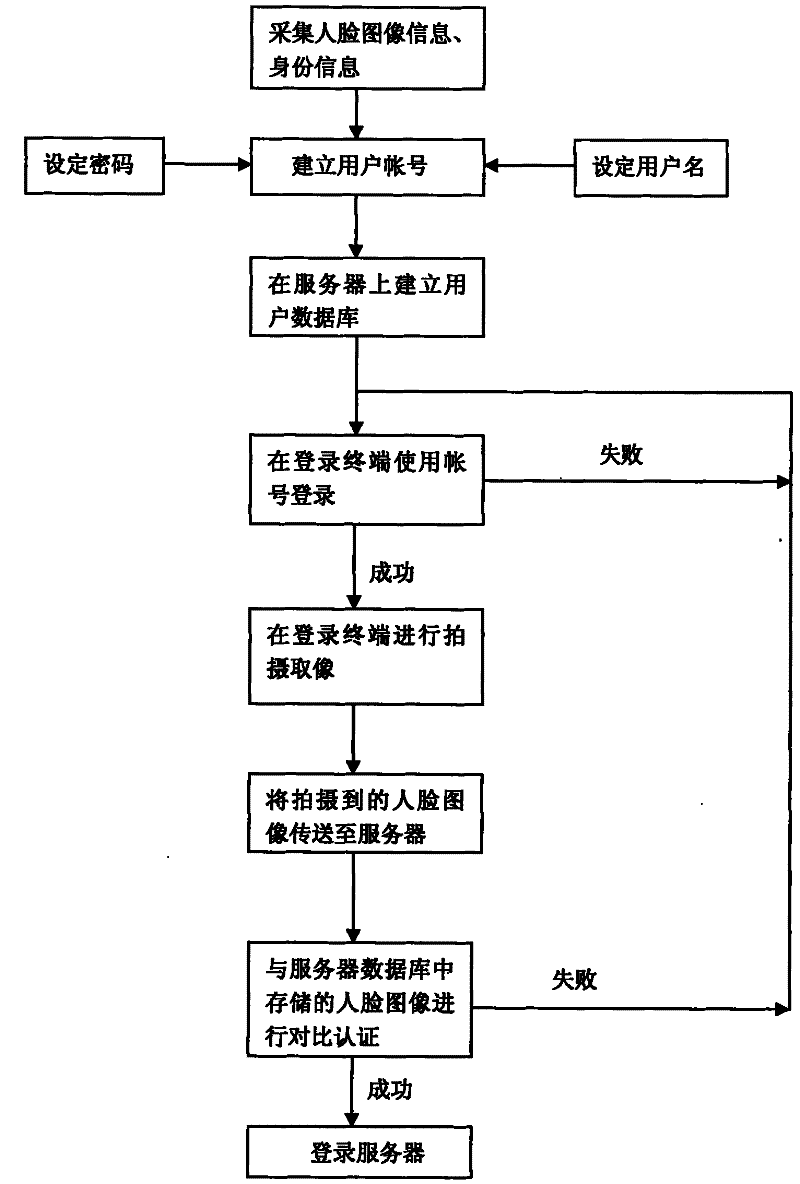

Face recognition login method and system

InactiveCN102164113AAvoid Security CompromiseCharacter and pattern recognitionTransmissionPattern recognitionPassword

The invention discloses a face recognition login method and a face recognition login system. The face recognition login method comprises the following steps of: 1) shooting a face image at a login terminal by using a camera device; 2) transmitting the shot face image to a server; and 3) comparing the shot face image with the face image stored in a database of the server, determining login is successful if the shot face image is the same as the stored face image, and determining the login is failed if the shot face image is different from the stored face image. By the method and the system, damages, caused by password disclosure, to the security of a personal account can be effectively avoided, and login verification is realized by using own face so as to achieve convenience and practicability.

Owner:SHENZHEN LIANTONG WONDER TECH

Retrieving personal account information from a web site by reading a credit card

A method of accessing personal account information of a credit card (3400) over a global communication packet-switched network (306). At a user location disposed on the network (306), a machine-resolvable code (MRC) (3402) of the credit card (3400) of a user is read with a reading device (3410). Coded information is extracted from the MRC (3402). Routing information associated with the coded information is obtained, which routing information corresponds to the personal account information of the user stored on a credit card company server (3300) disposed on the network (306). The user location connects to the credit card company server (3300) across the network in accordance with the routing information. The personal account information is returned from the credit card company server (3300) to the user location. The personal account information is then presented to the user at the user location.

Owner:RPX CORP +1

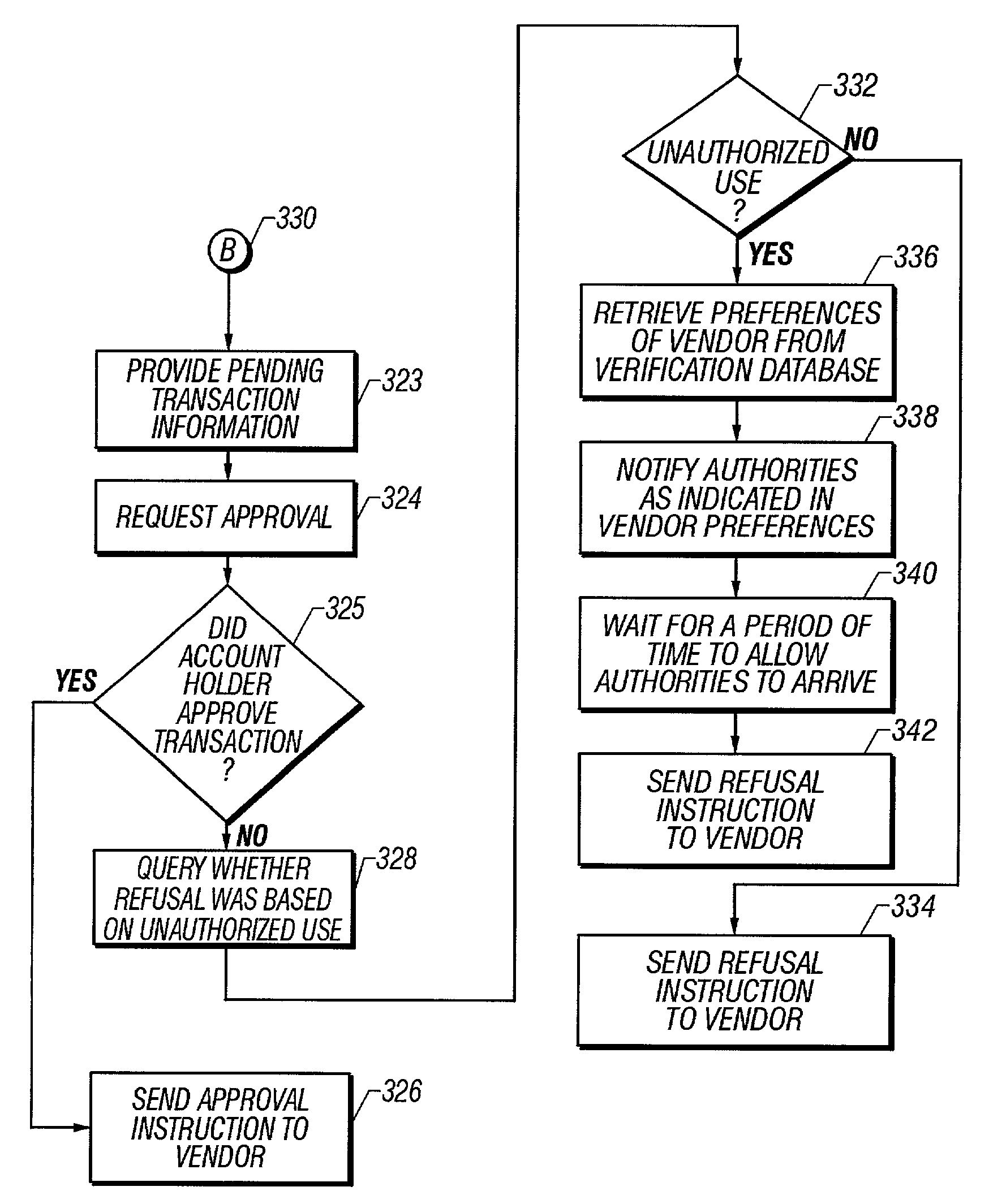

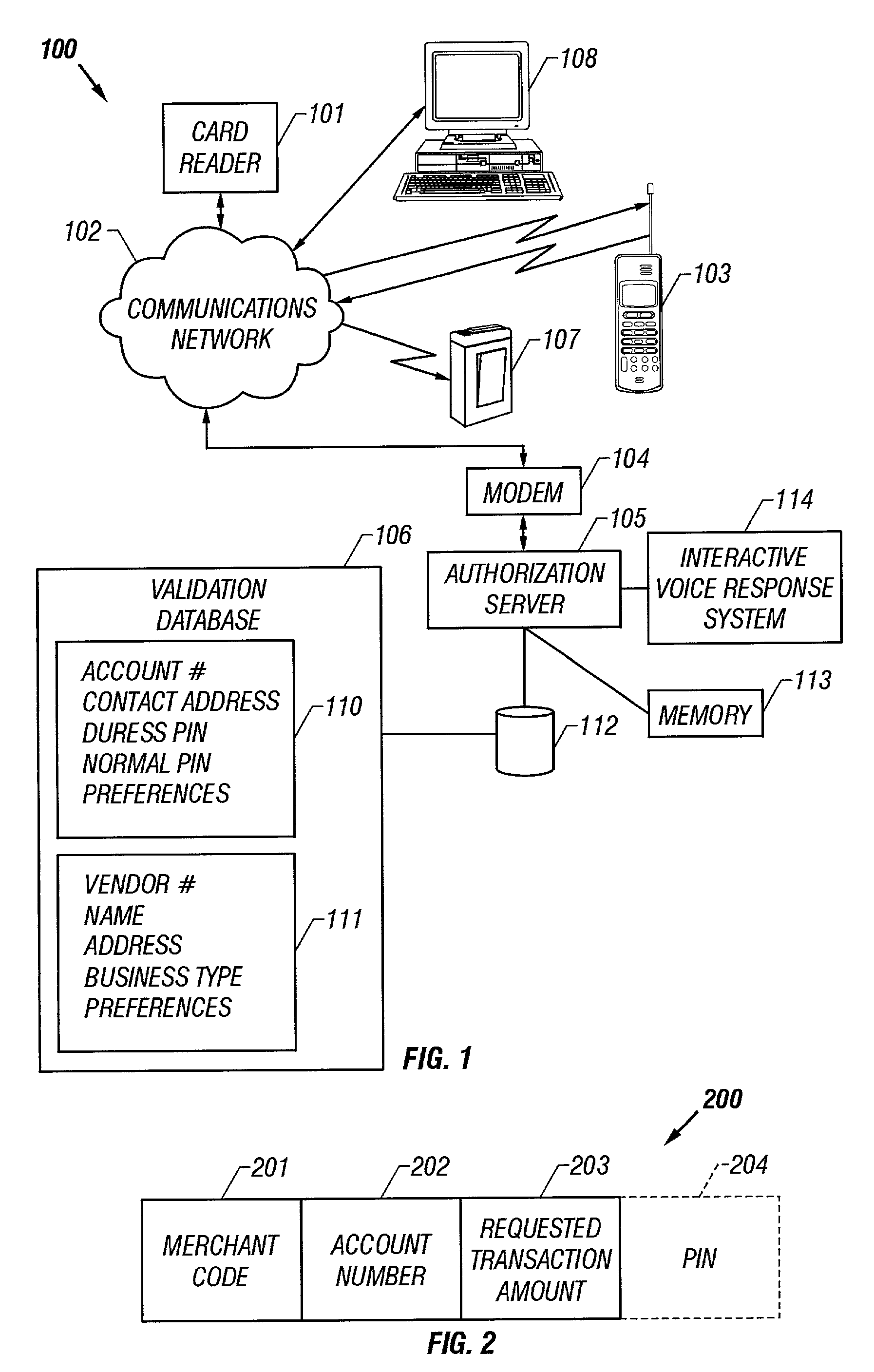

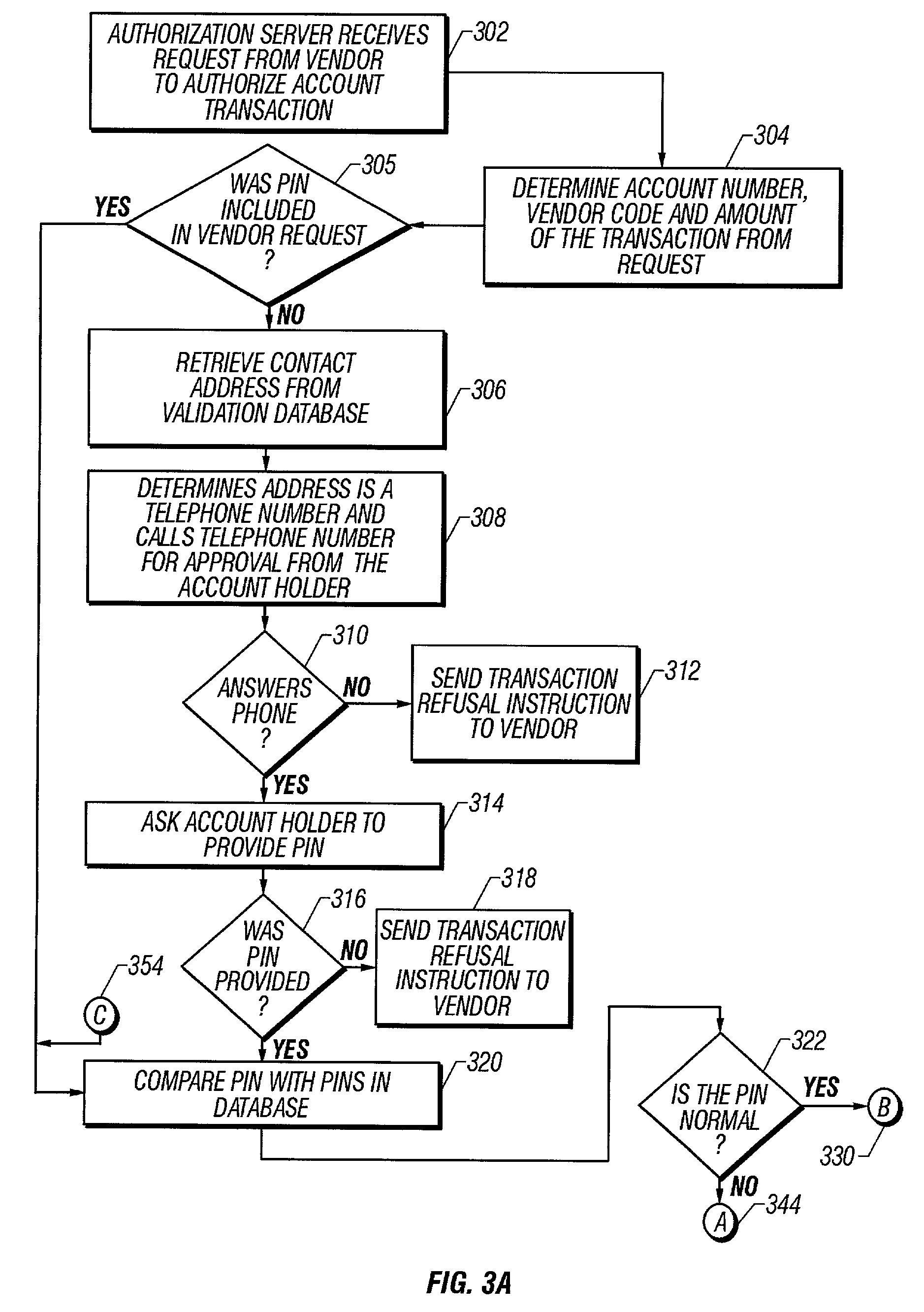

Detection of unauthorized account transactions

Account transaction protection is provided during the automated authorization process of a charge account, a debit account, a personal account or a business account. After a vendor asks the authorization service provider to approve a pending transaction, the authorization service provider automatically contacts an account holder asking for approval or refusal of the pending transaction. The contact is made by telephone, or computer network, such as the Internet. After entering a PIN to establish identity, the account holder approves or rejects the pending transaction after receiving a validation request message detailing the facts of the transaction. The PIN may be a normal PIN or a duress PIN. If the duress PIN is used, indicating the account holder is under duress to approve the pending transaction, the service provider notifies the authorities. Similarly, if the account holder indicates that refusal is due to unauthorized use, the service provider contacts the authorities.

Owner:PAYPAL INC

Foldable data card assembly and method

ActiveUS8256682B2Other printing matterCredit registering devices actuationComputer hardwareBiological activation

A foldable data card assembly and method are disclosed. The foldable data card assembly comprises a base assembly with a left portion, a middle portion, and a right potion. The left portion or the middle portion contains an aperture. A data card is enclosed within the base assembly such that the aperture is aligned with a special number on the data card. A security barrier is placed adjacent to the personal account number on the data card, but the security barrier is not placed between the aperture and the special number on the card. During manufacture, the special number is read from the card through the aperture, and the special number used to generate activation information which is printed on the package. The activation information is read at the point of sale, and used to activate the account associated with the activation information.

Owner:E2INTERACTIVE INC D B A E2INTERACTIVE

Performing an e-commerce transaction from credit card account information retrieved from a credit card company web site

A method of conducting an e-commerce transaction on a global communication network (306) by using personal account information of a credit card retrieved from a credit card company server on the network (306). At a user location disposed on the network, a machine-resolvable code (MRC) (3402) of the credit card (3400) of a user is read with a reading device (3410). Coded information is extracted from the MRC (3402). Routing information associated with the coded information is obtained, which routing information corresponds to the personal account information of the user stored on a credit card company server (3300) disposed on the network (306). The user location connects to the credit card company server (3300) across the network (306) in accordance with the routing information. The personal account information is returned from the credit card company server (3300) to the user location. The personal account information is then presented to the user at the user location. A hyperlink to a vendor web site (3422) is provided in the personal account information for automatic connection of the user location to the vendor web site in response to selection thereof. Web site information of the vendor web site (3422) is displayed in response to the user selecting the hyperlink. The user can then purchase a product of the vendor web site (3422).

Owner:RPX CORP +1

Browser-based suspensible novel network instant chat method

InactiveCN102045269ADoes not take up resourcesImprove experienceData switching networksInternal memoryComputer network

The invention relates to a browser-based suspensible novel network instant chat method. A chat interface can suspend on a browser page, and during instant chat, the popped two-person or multi-person instant chat window can suspend on the browser page. The method has the advantages that: personal computer resources of the user is not occupied, the internal memory and a hard disk are not occupied, the speed is high, and the method is convenient to use; due to the browser-based mode, the security of personal account number, data and chat contents are well ensured and the personal account number, data and chat contents are hardly stolen; besides, the chat interface and the chat window suspend on the page functionally, the chat interface and the chat window can be randomly dragged, and the method meets humanization requirement, and has good user experience.

Owner:于琨洪

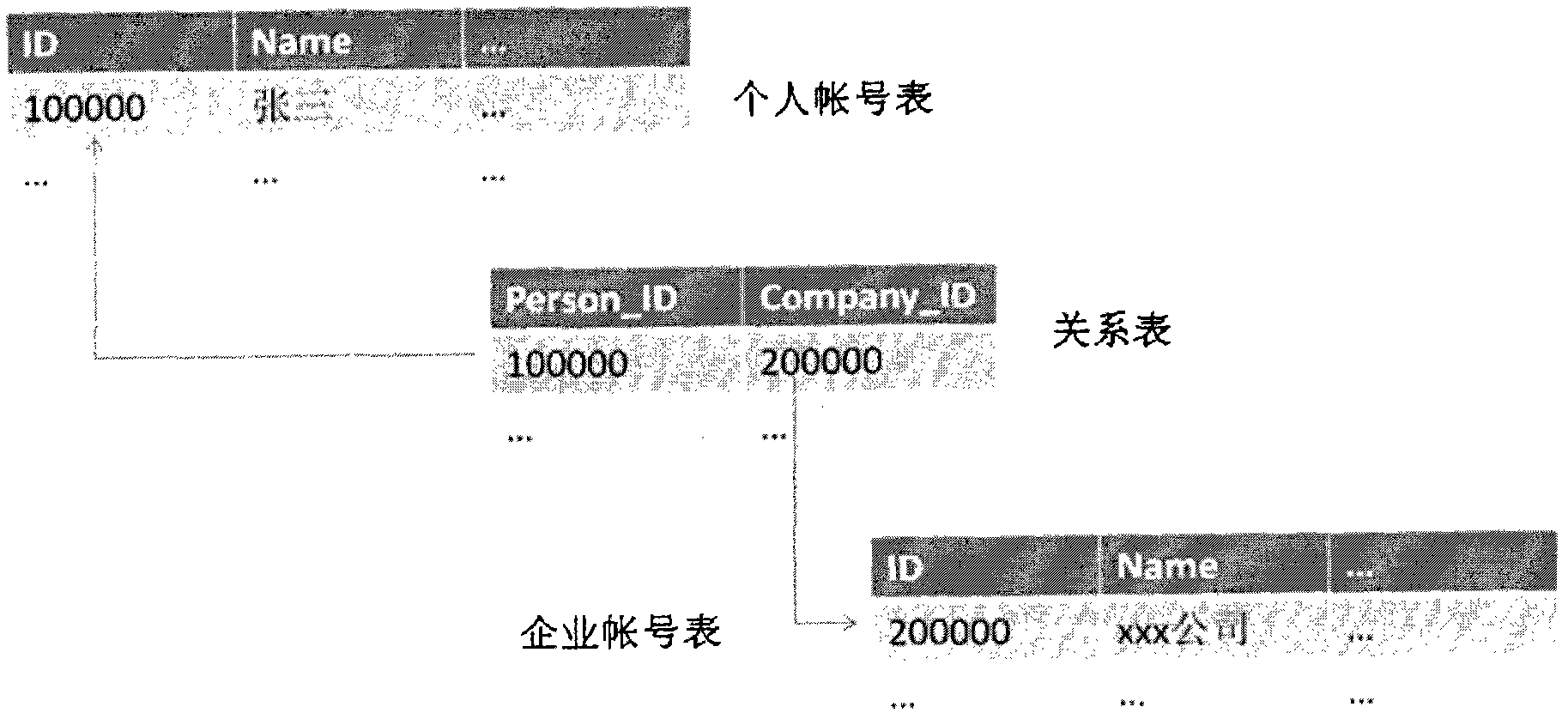

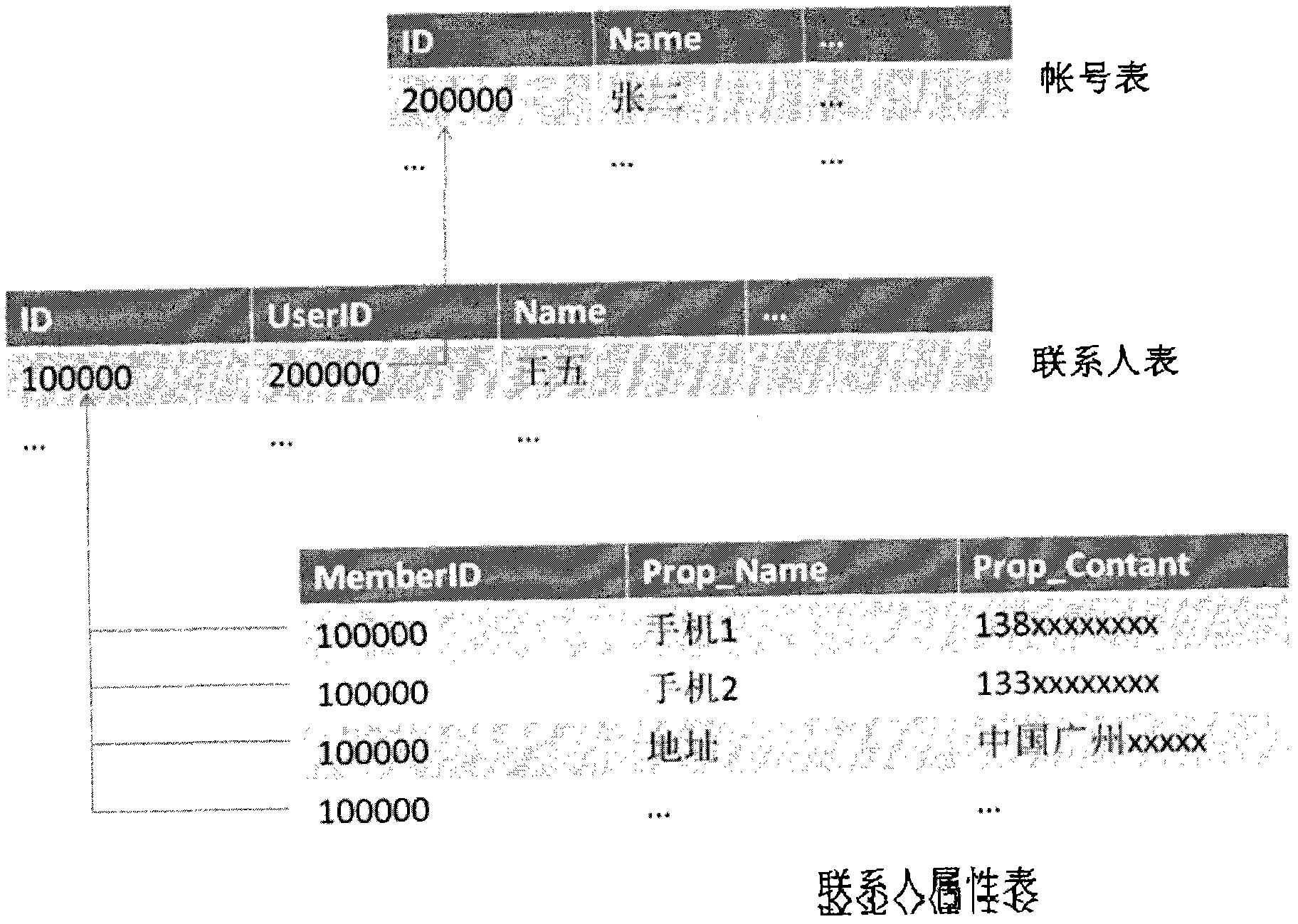

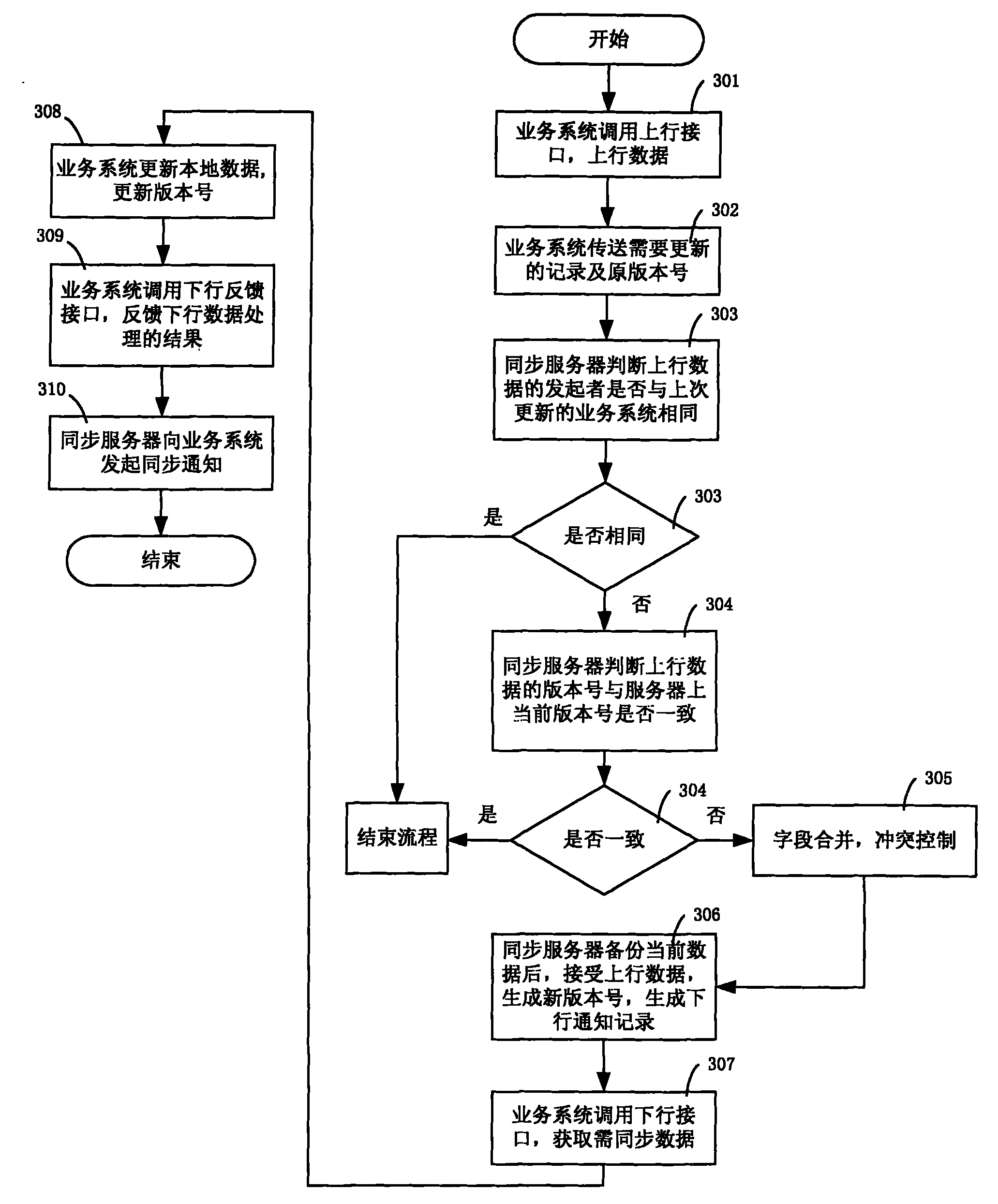

Method and system for realizing multisystem address-book data fusion

The invention discloses a method and system for realizing multisystem address-book data fusion. The method comprises the following steps of: setting a uniform address-book platform system which is used for storing a uniform address-book; respectively storing personal accounts and enterprise accounts in address-book data into different account lists, and storing a corresponding relation between the personal accounts and the enterprise accounts in a relation list; and after receiving an address-book data report request which is sent from a business system by the uniform address-book platform system, judging whether the address-book data in the report request is consistent with local existing address-book data or not; if so, finishing a flow; otherwise, updating the existing address-book data according to the address-book data in the report request, and sending the updated address-book data to the other business systems. According to the invention, individual address-book data stored in various application systems and user terminals can be effectively fused, so as to realize the integration of a personal address book and an enterprise address book.

Owner:CHINA TELECOM CORP LTD

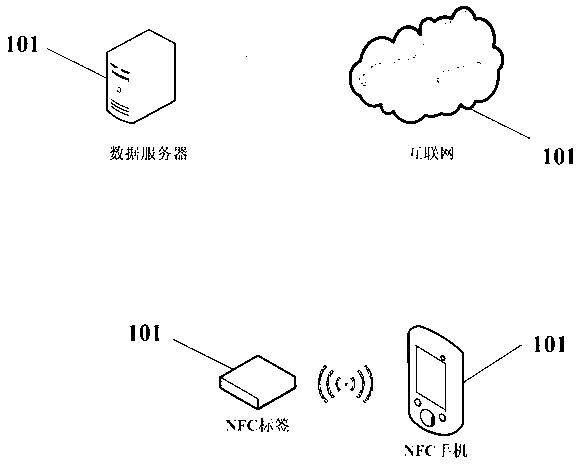

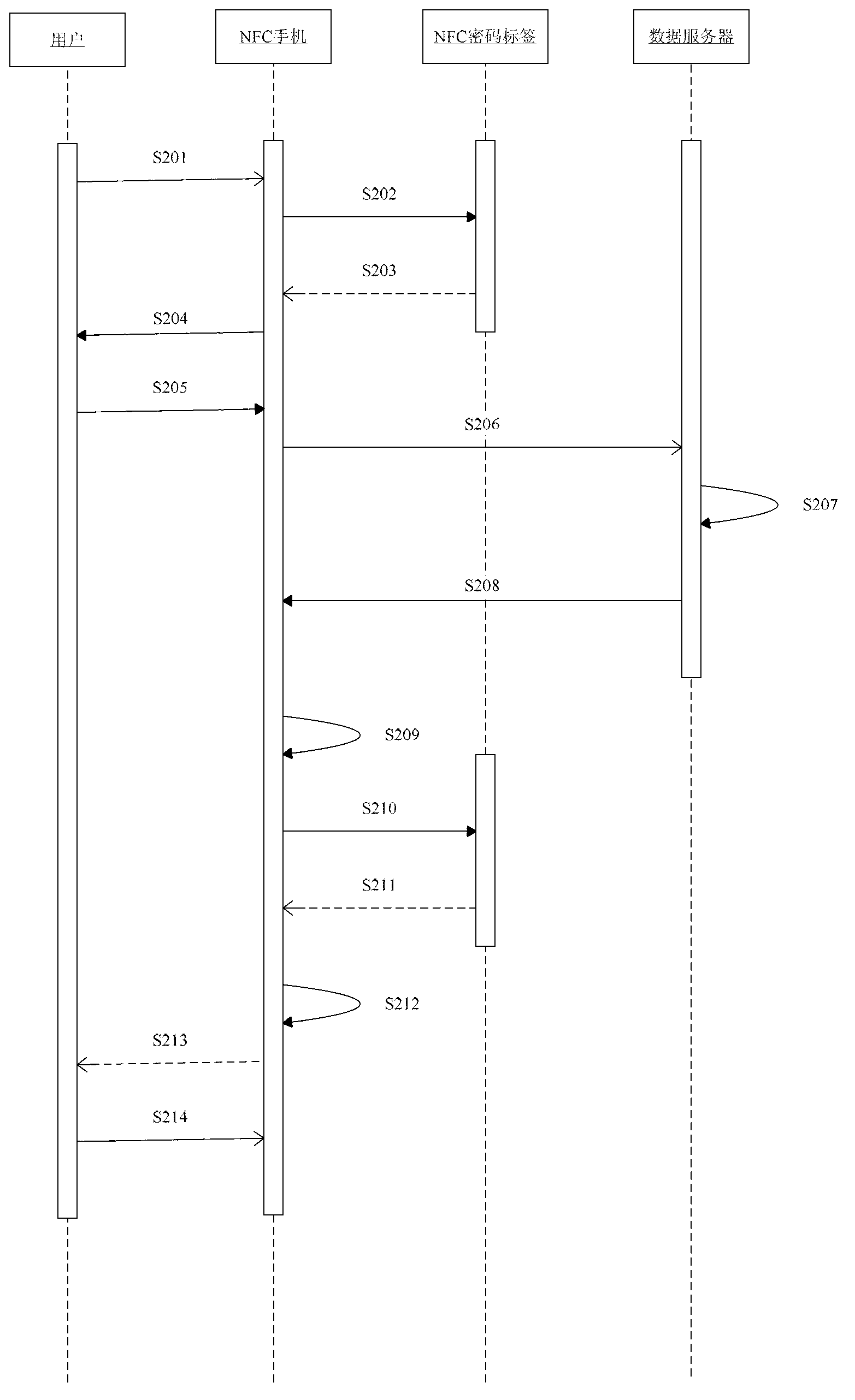

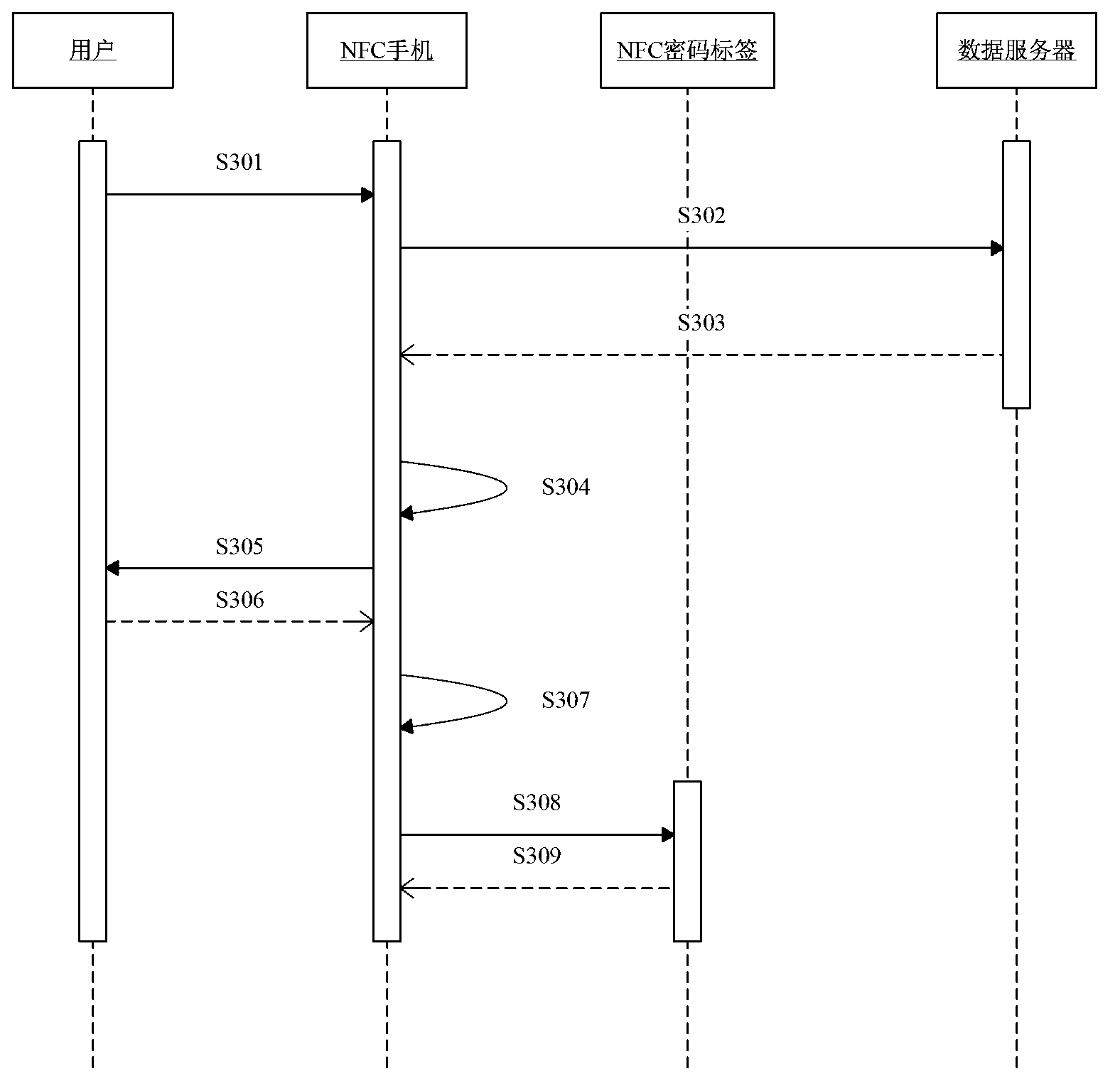

NFC (near field communication) personal account information management system and method for implementing same

InactiveCN103023925AEasy to carryEnsure safetyUser identity/authority verificationRecord carriers used with machinesInternet communicationPassword

The invention discloses an NFC (near field communication) personal account information management system on the basis of RFID (radio frequency identification) and a method for implementing the NFC personal account information management system. The system comprises an encrypted NFC tag, an NFC mobile phone and a data server capable of being in communication connection with the NFC mobile phone by the internet. The method includes that the NFC mobile phone reads information of the NFC tag and transmits the information of the NFC tag and user registration information to the data server; the data server verifies the user registration information, and provides an access password of the NFC tag after the user registration information successfully passes verification, and the NFC tag is encrypted by a public key; and the NFC mobile phone acquires the access password of the NFC tag by means of decoding by the aid of a private key; and finally, personal account information stored in the NFC tag is copied and restored on the NFC tag by the aid of the decoded access password. By the method synchronously provided with the system, a client can be quite efficiently and safely store and access the client account information in an encryption manner only by the aid of the NFC tag, and various identification verification procedures can be completed automatically on the internet.

Owner:SHANGHAI HUAYUAN ELECTRONICS

Shopping using wireless communication

This is a system to assist shoppers through a handheld wireless communications device which is Bluetooth-enabled (as an example) (a registered trademark), connected to a barcode reader to scan Universal Product Code (UPC) barcodes on items in the store. The shopper is required to login to the store's shopping system using this device once a personal account has created. While shopping, scan the items, view their prices and running total and finally complete the purchase. This system is also capable of (as an example) consolidating a personal shopping list created remotely through vendor's web site or stored on the personal communication device and the shopping cart to help and enhance the shopping experience.

Owner:INT BUSINESS MASCH CORP

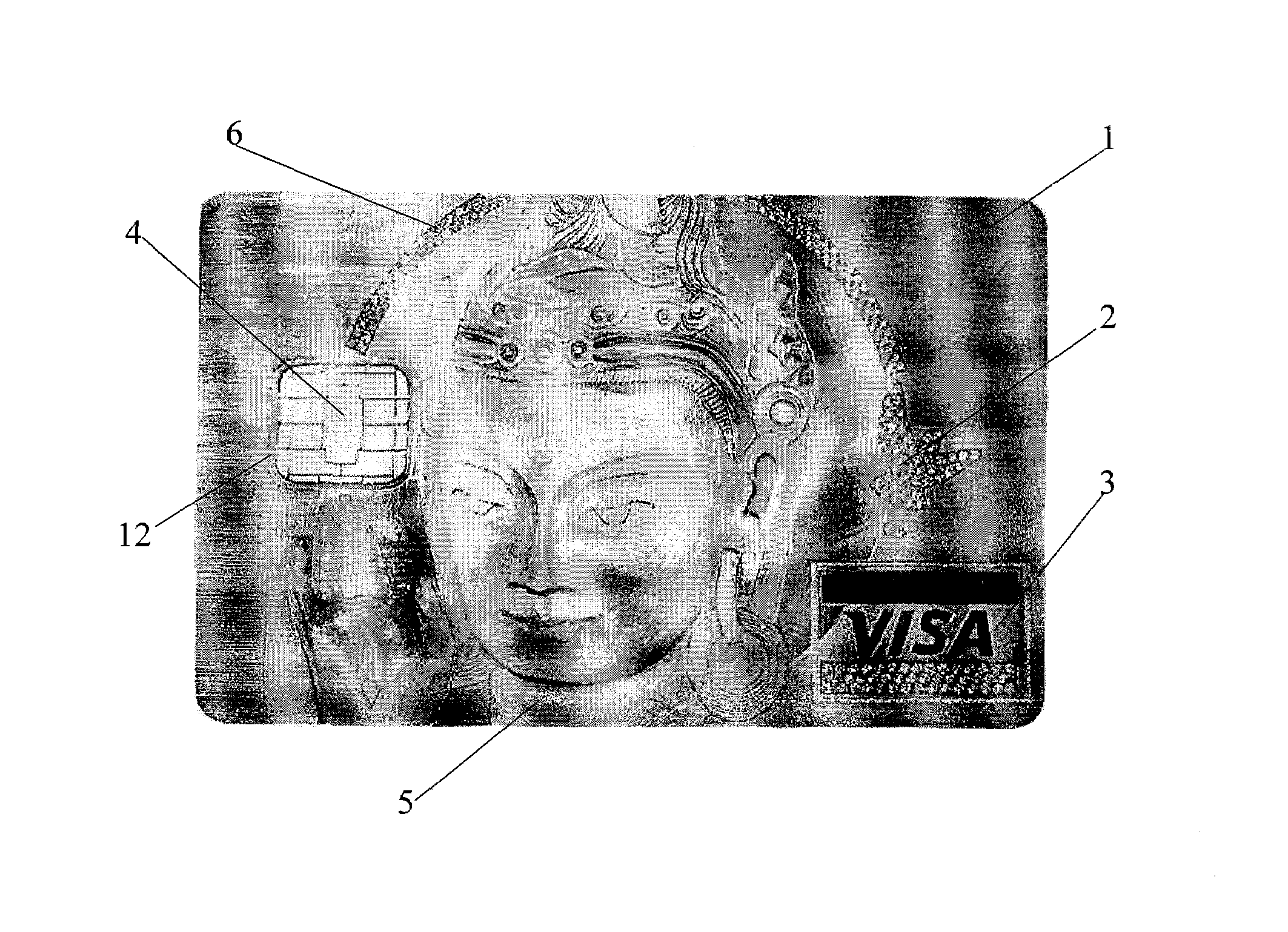

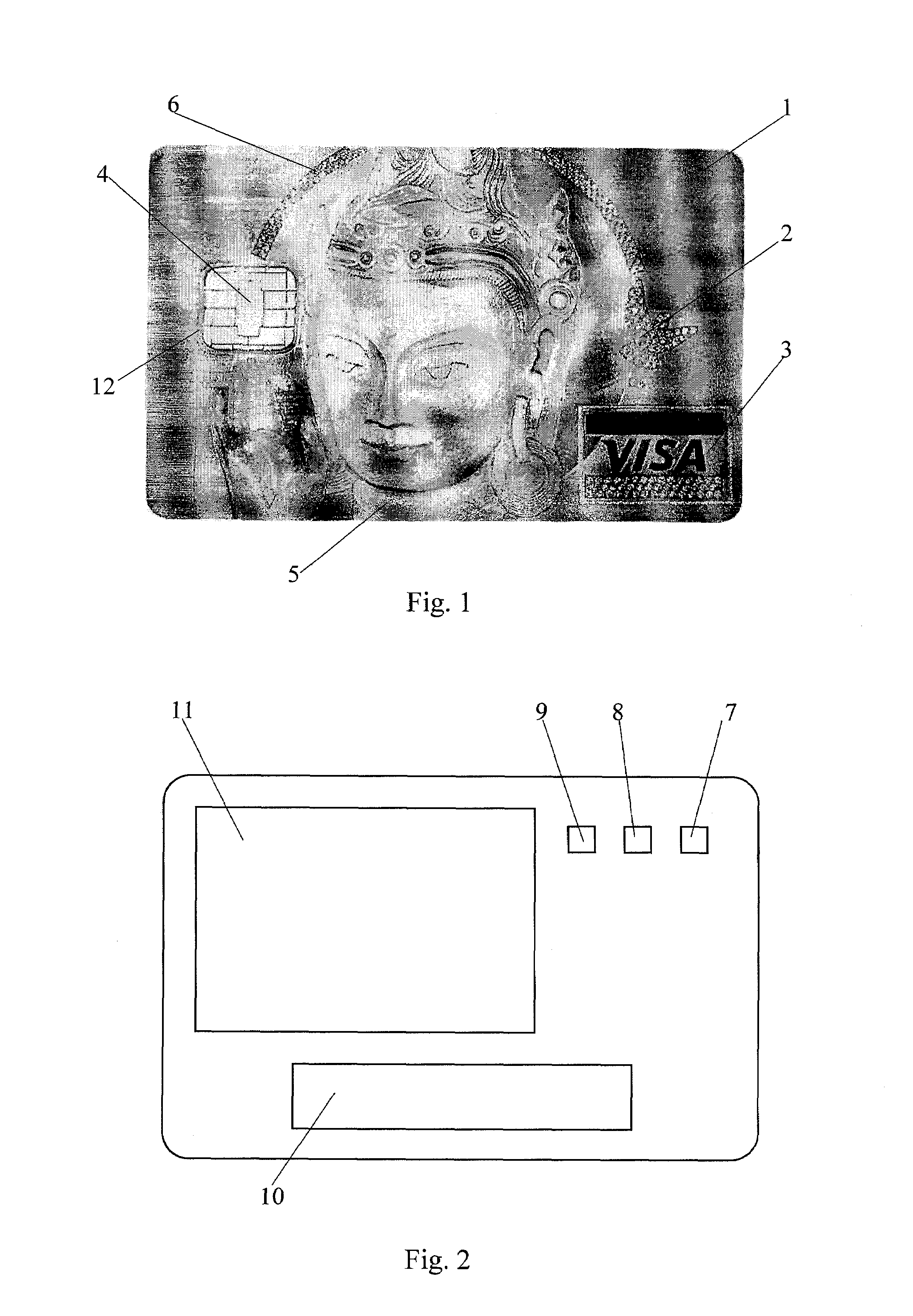

Payment V.I.P. card

This invention relates to a universal financial product and enables to use it for managing money resources, e.g., sums being on a personal account. The housing of the pay card may be made of a precious or rare metal, bone, finewood; the elements of the features of a pay system and an issuing bank as well as those of protection and personalization are also made of the said materials, including precious stones, by engraving and inlaying. A place is provided for a standard electronic chip, which may be replaced. Periods of use of the pay card and the reliability of its level of protection against imitating and counterfeiting are increased.

Owner:AIBAZOV OLEG UMAROVICH

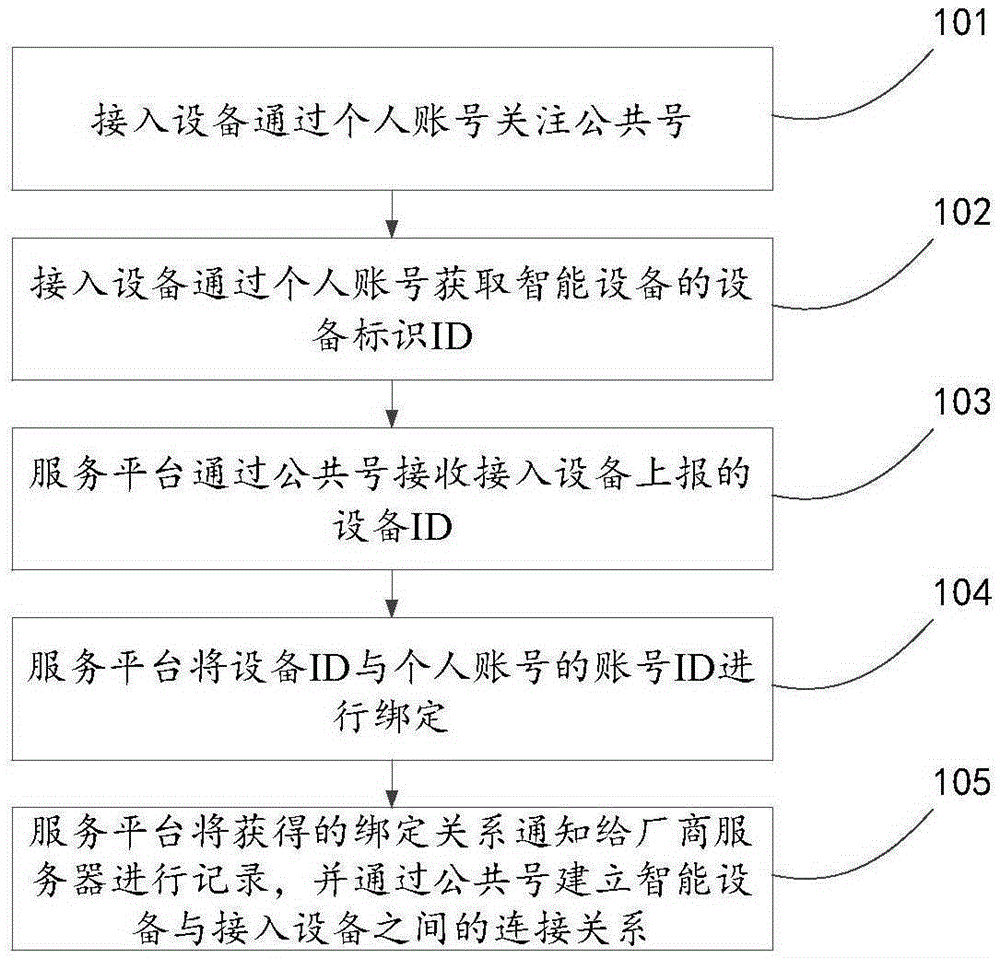

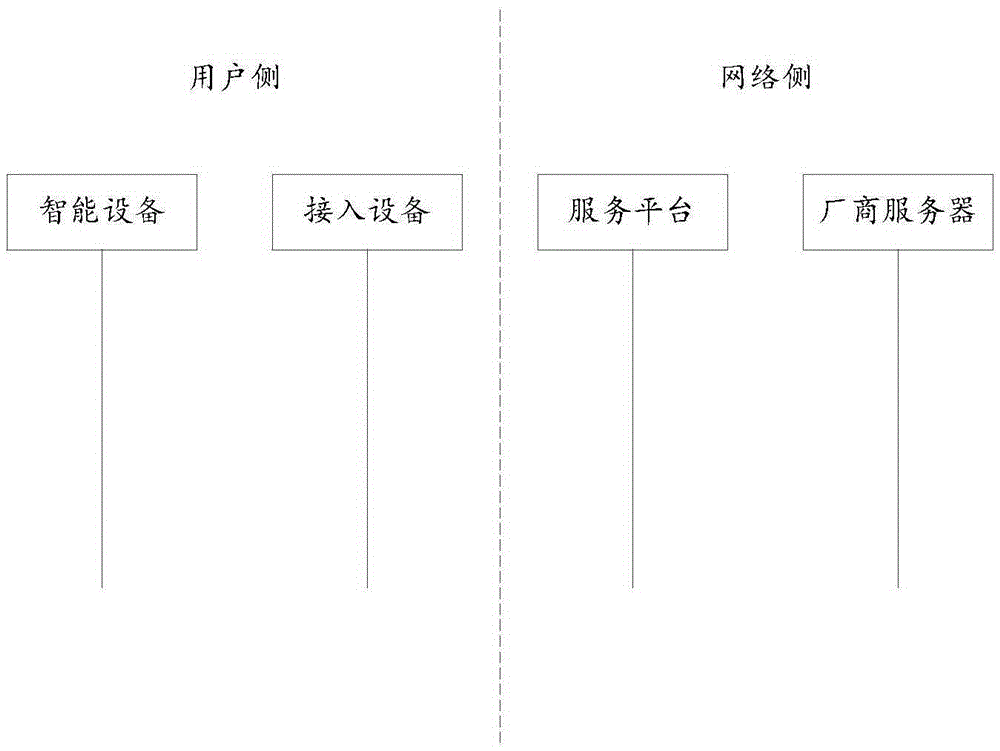

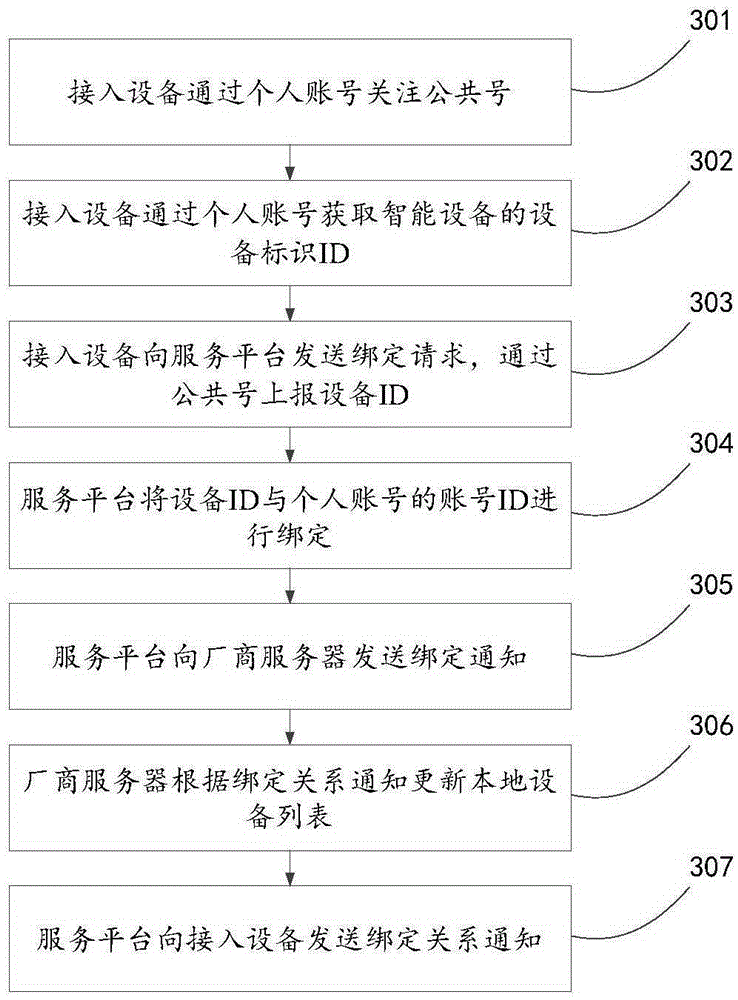

Intelligent device connection method, device and system

The invention discloses an intelligent device connection method, device and system, relating to the technical field of Internet and solving the problem that a device manufacturer needs to develop an intelligent device APP. The method includes that an access device follows a common account through a personal account and acquires the device identity ID of an intelligent device via the personal account, the common account is a common management account developed by a service platform for the intelligent device, and the device identity ID is the only device identity ID distributed by the service platform for the intelligent device before the intelligent device leaves the factory; the service platform receives the device identity ID reported by the access device via the common account and binds the device identity ID to the ID of the personal account; the service platform informs a manufacturer server the acquired binding relation for recording; and the service platform establishes the connection between the intelligent device and the access device via the common account. The intelligent device connection method, device and system are mainly applied to the binding connection process of the intelligent device and a mobile phone.

Owner:BEIJING QIHOO TECH CO LTD +1

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com