Patents

Literature

6734results about "Payment circuits" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

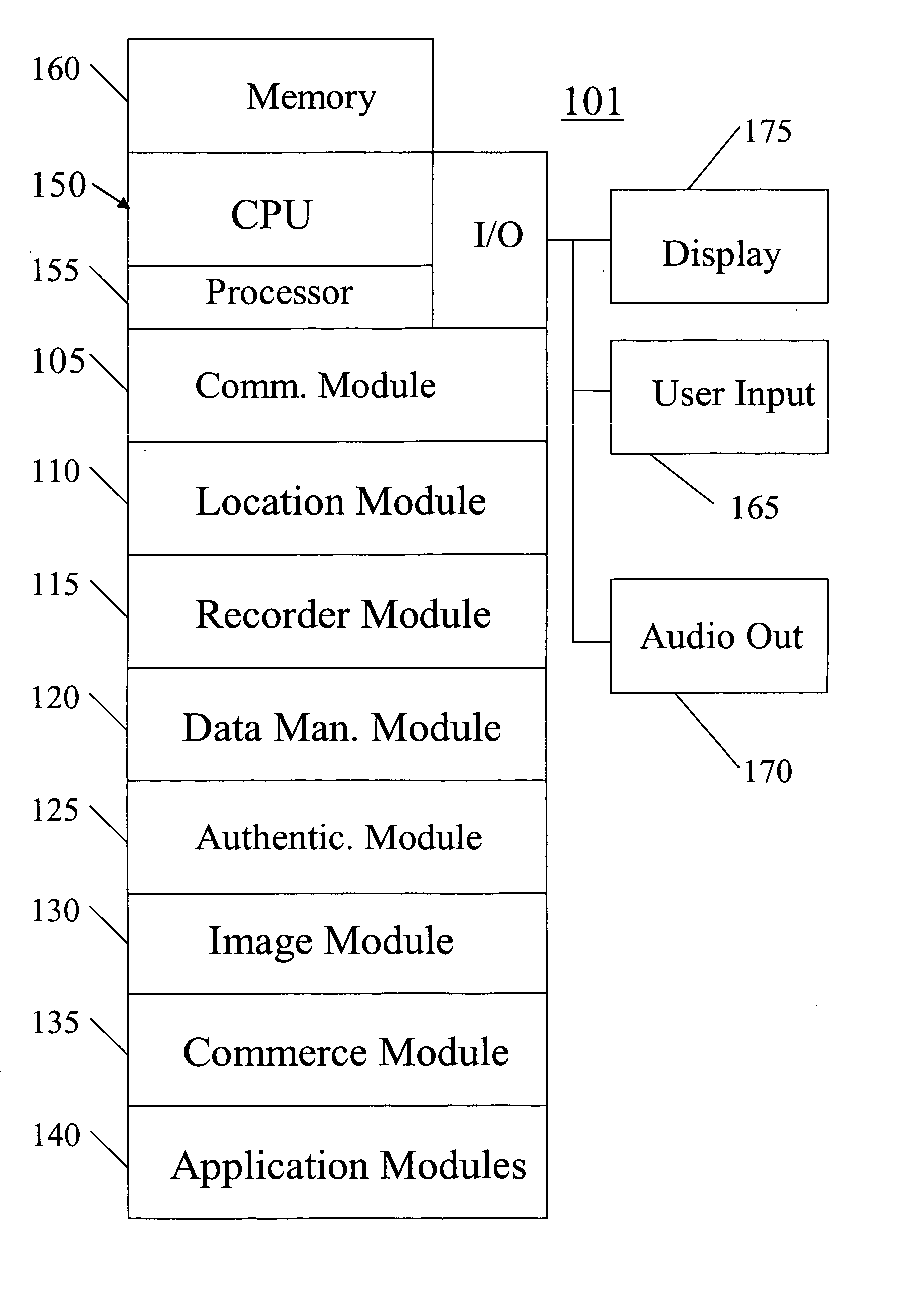

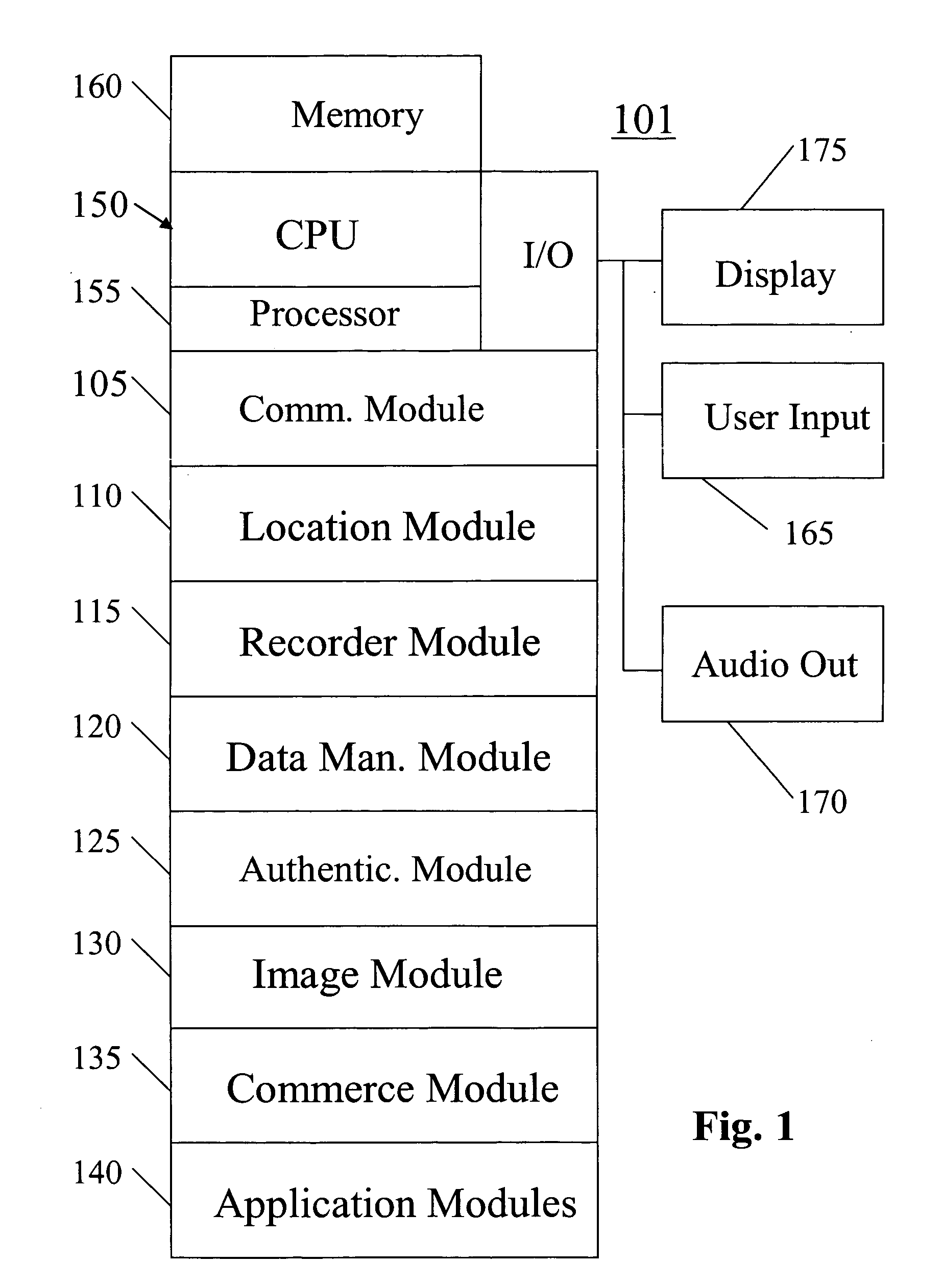

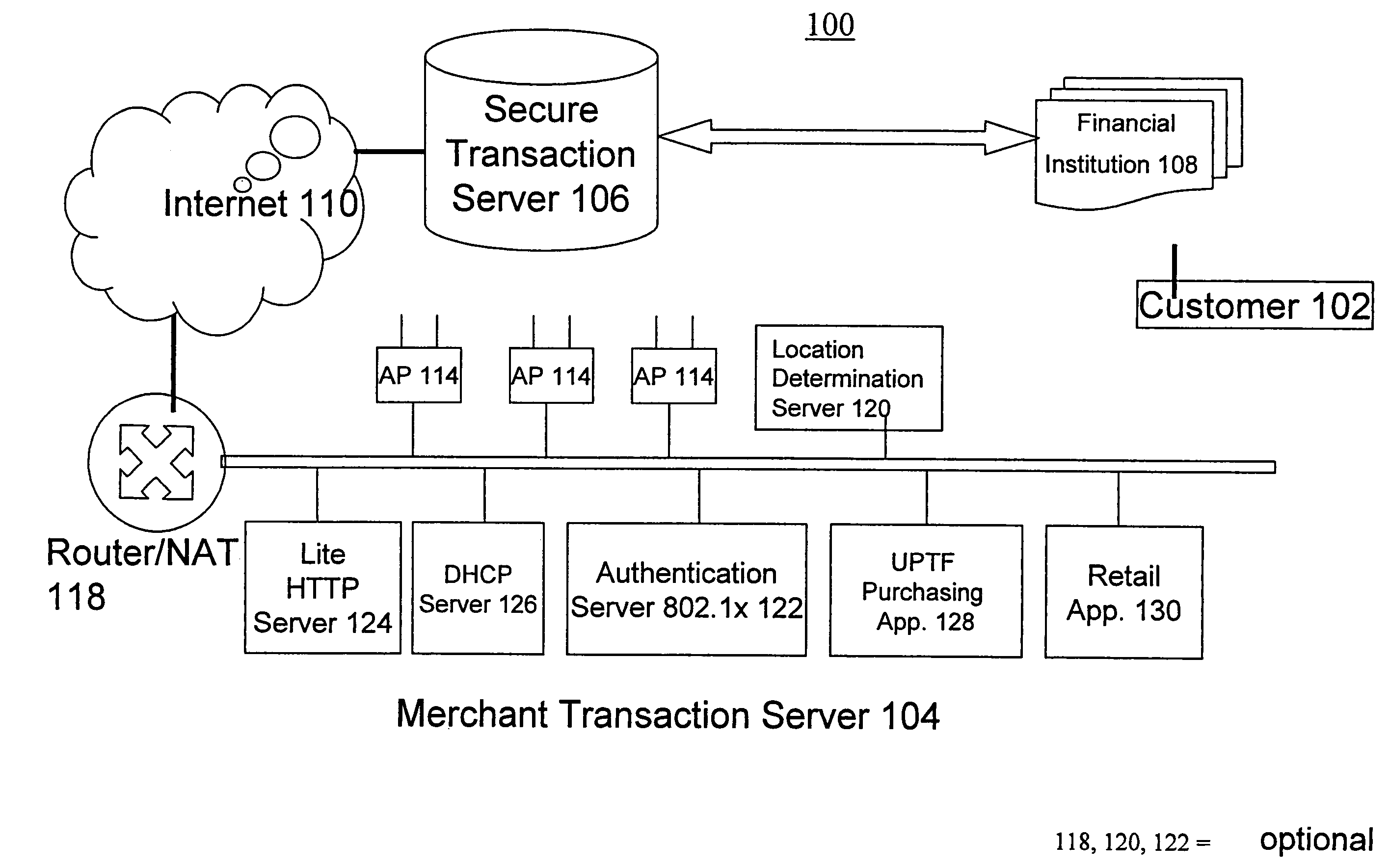

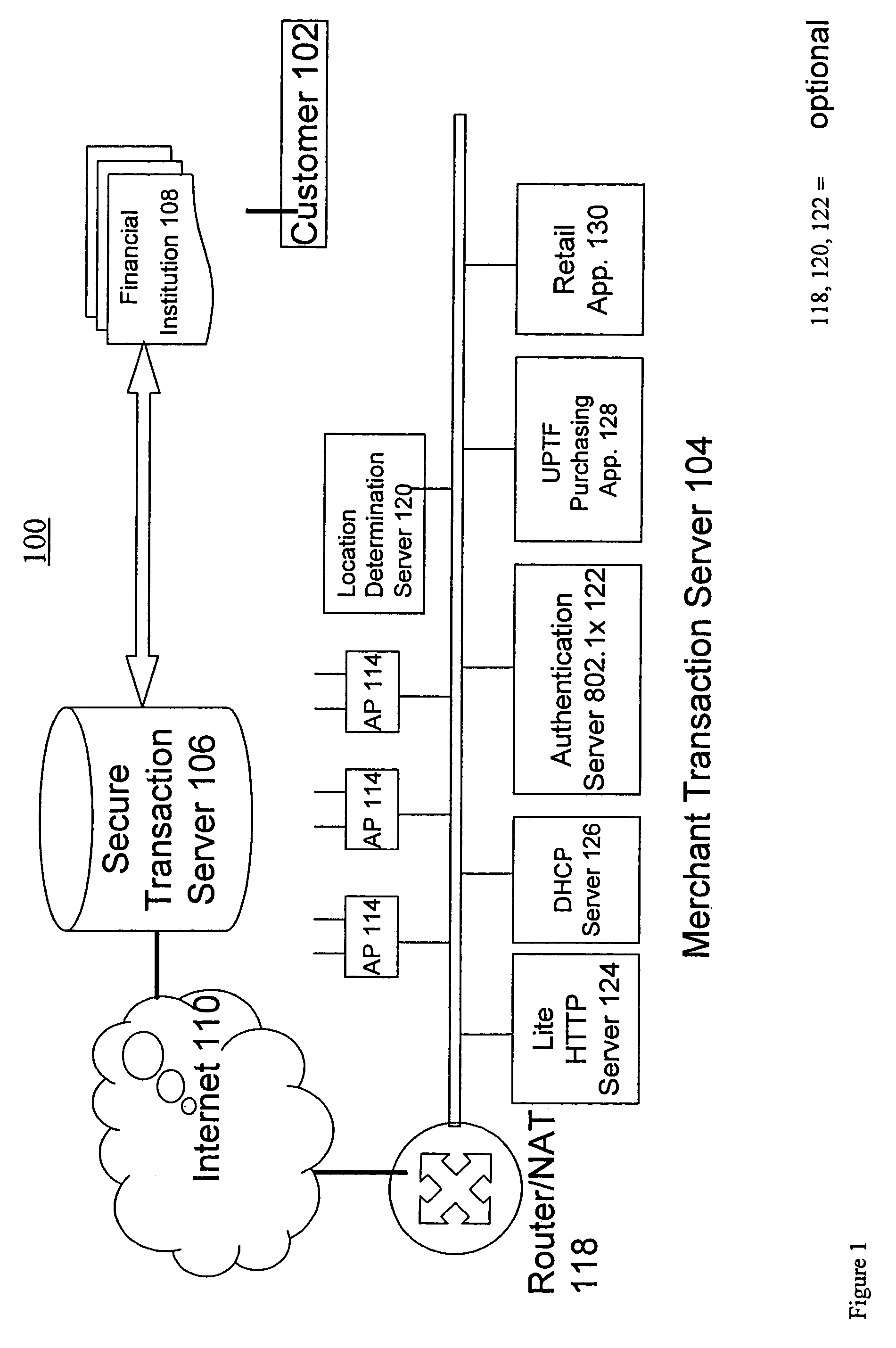

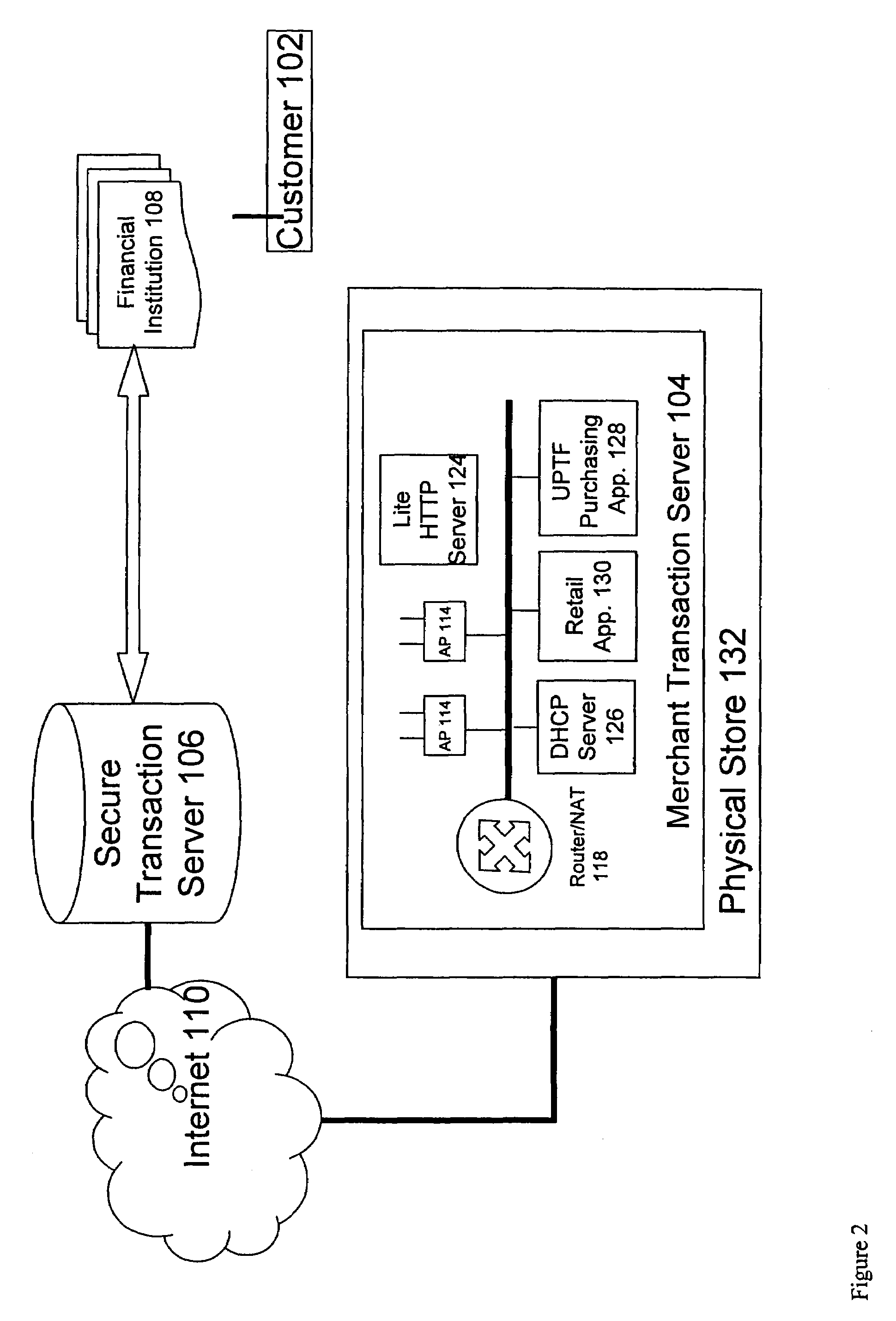

System, method, and computer program product for providing location based services and mobile e-commerce

ActiveUS20030220835A1Facilitating localized e-commerceFacilitate communicationAdvertisementsReservationsData fileDisplay device

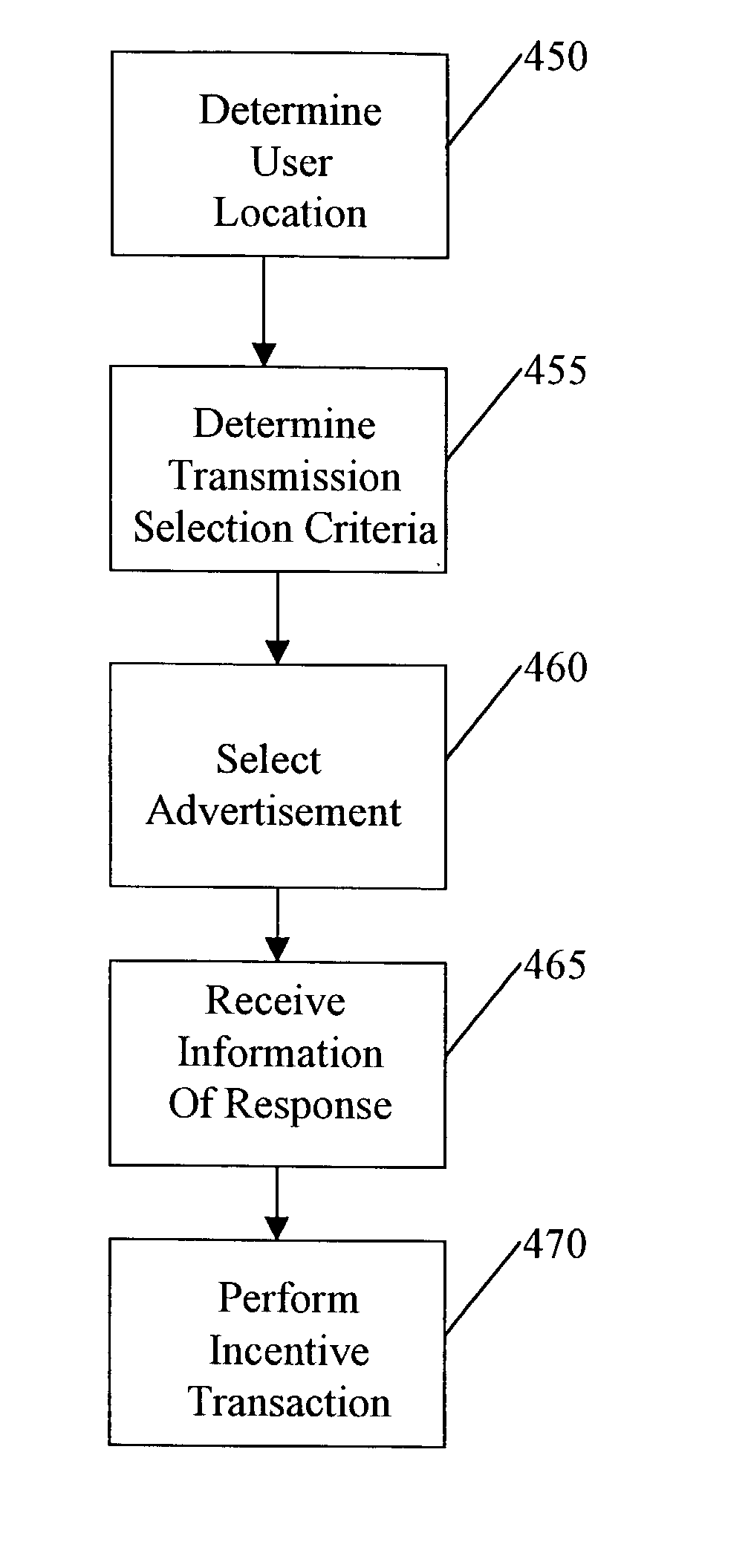

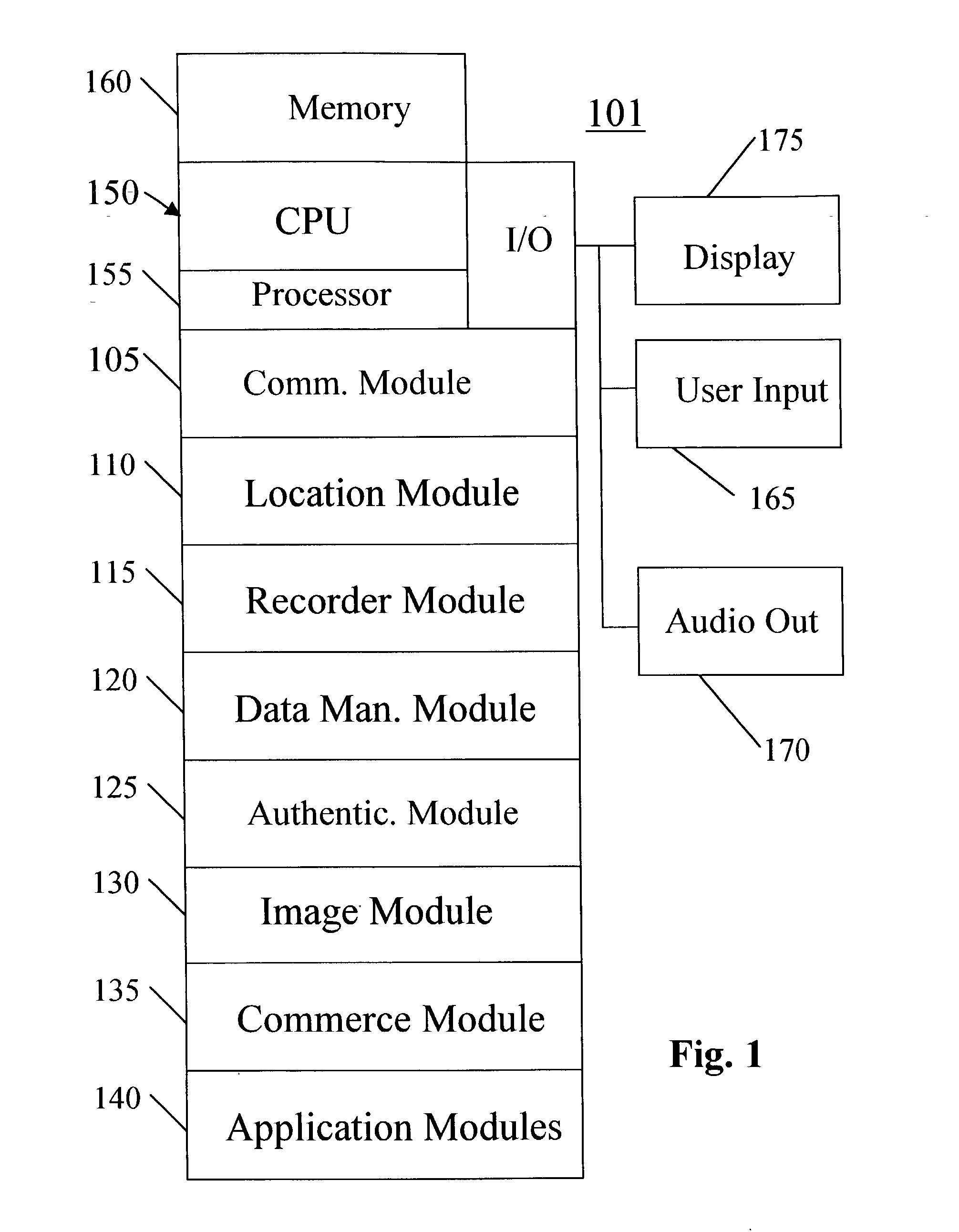

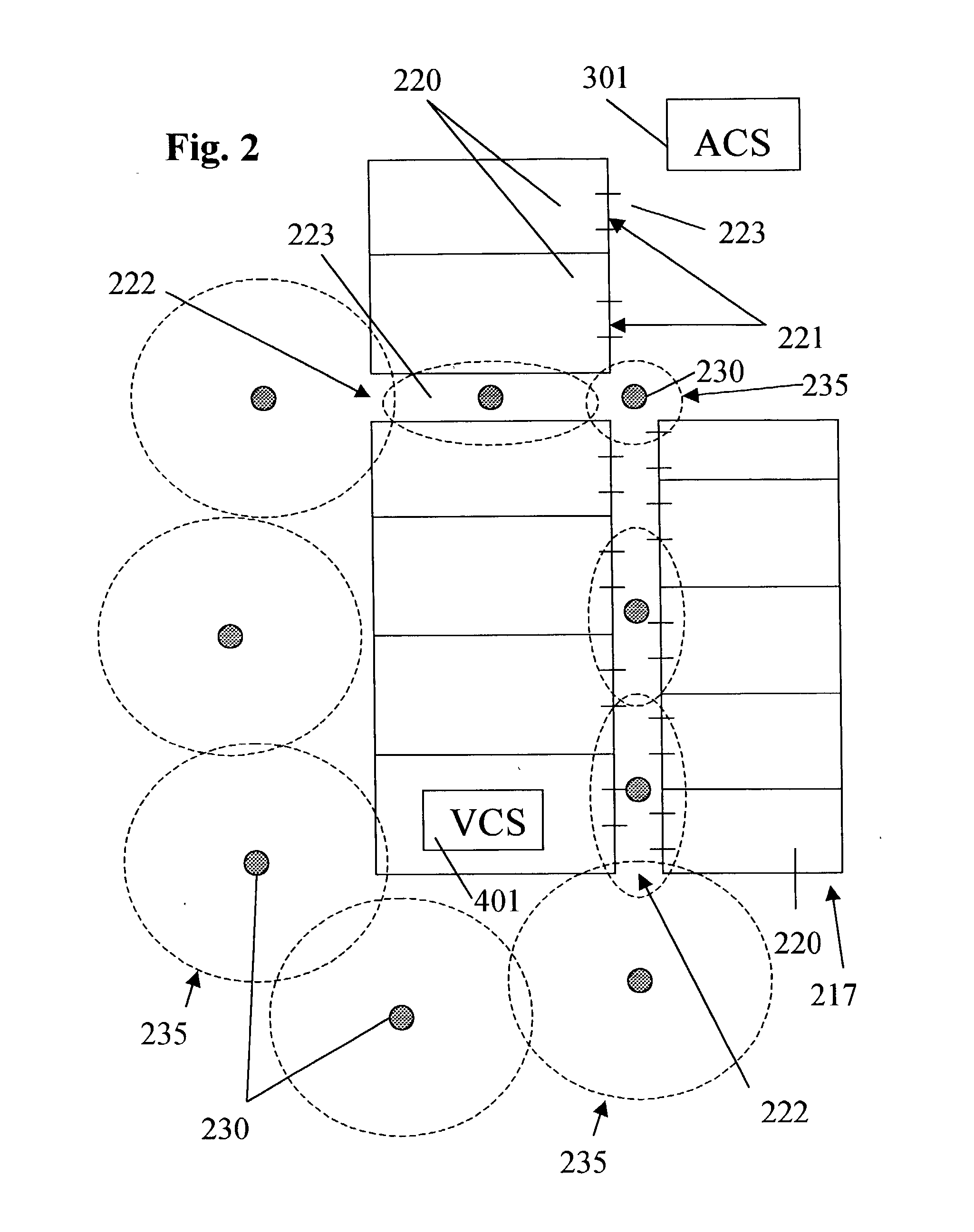

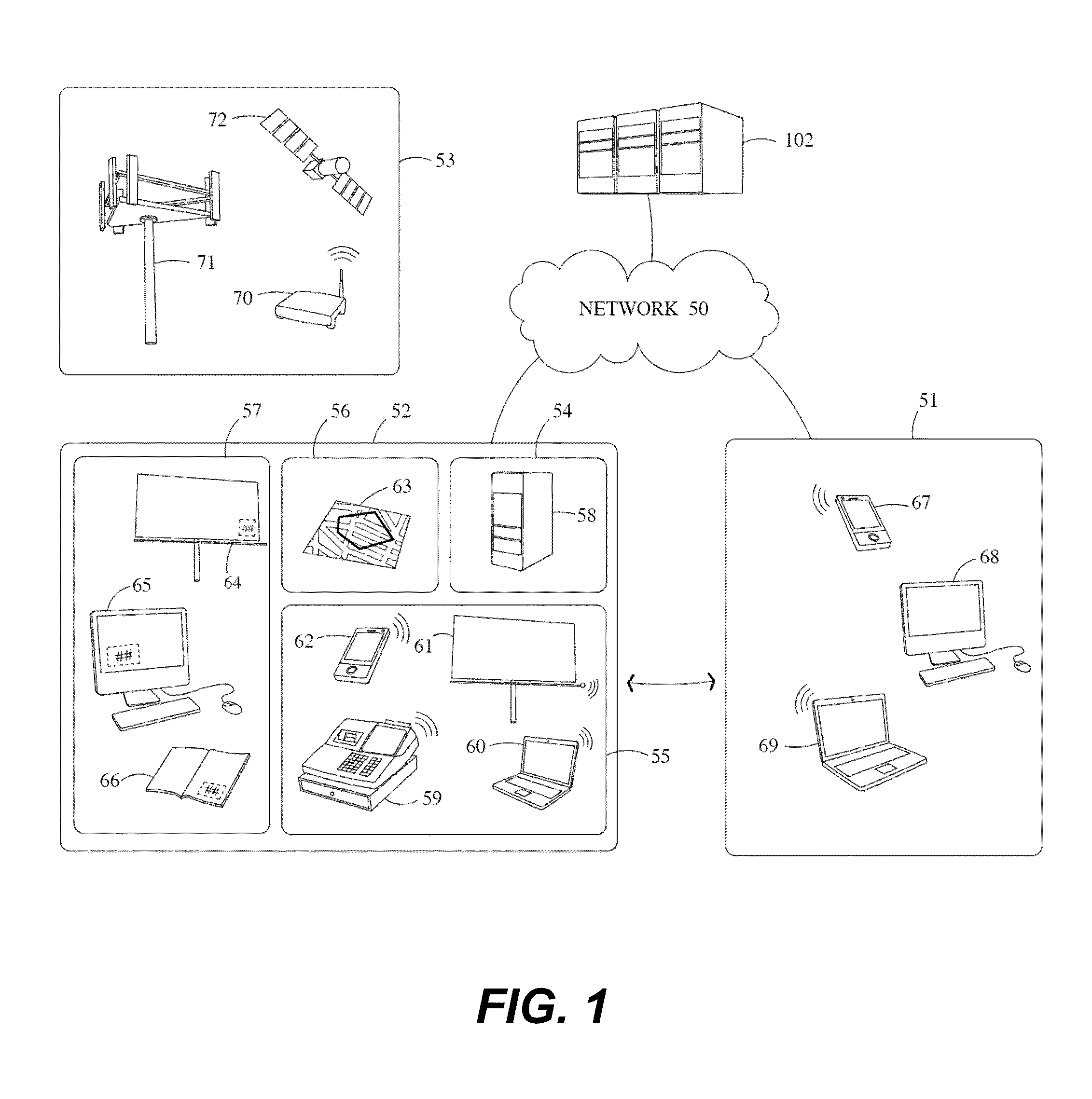

A system, method, apparatus and computer program product for providing location based functions and mobile e-commerce comprising a central processing unit including a processor, a storage device, and programming stored in the storage device, a display device, an audio input device, an audio output device, a communications module, a commerce module, an image module, and a location module. The programming controls the operation of the present invention to provide functions based on location data, to facilitate commercial exchanges by wirelessly exchanging payment and product information with venders, to identify services such as venders meeting selection criteria, to wirelessly exchange select information with other users and systems, to restrict and / or monitor the use of the device based on authorized user parameters, selecting one of a plurality networks through which to communicate, detecting a trigger for performing an action based on a change in location and sensed data, storing a voice annotation with a computer data file, determining service providers and associated communication parameters, contemporaneously maintaining a wireless voice and data link, providing a system for selecting and delivering mobile advertisements, and many other functions and services that are described herein.

Owner:GULA CONSULTING LLC

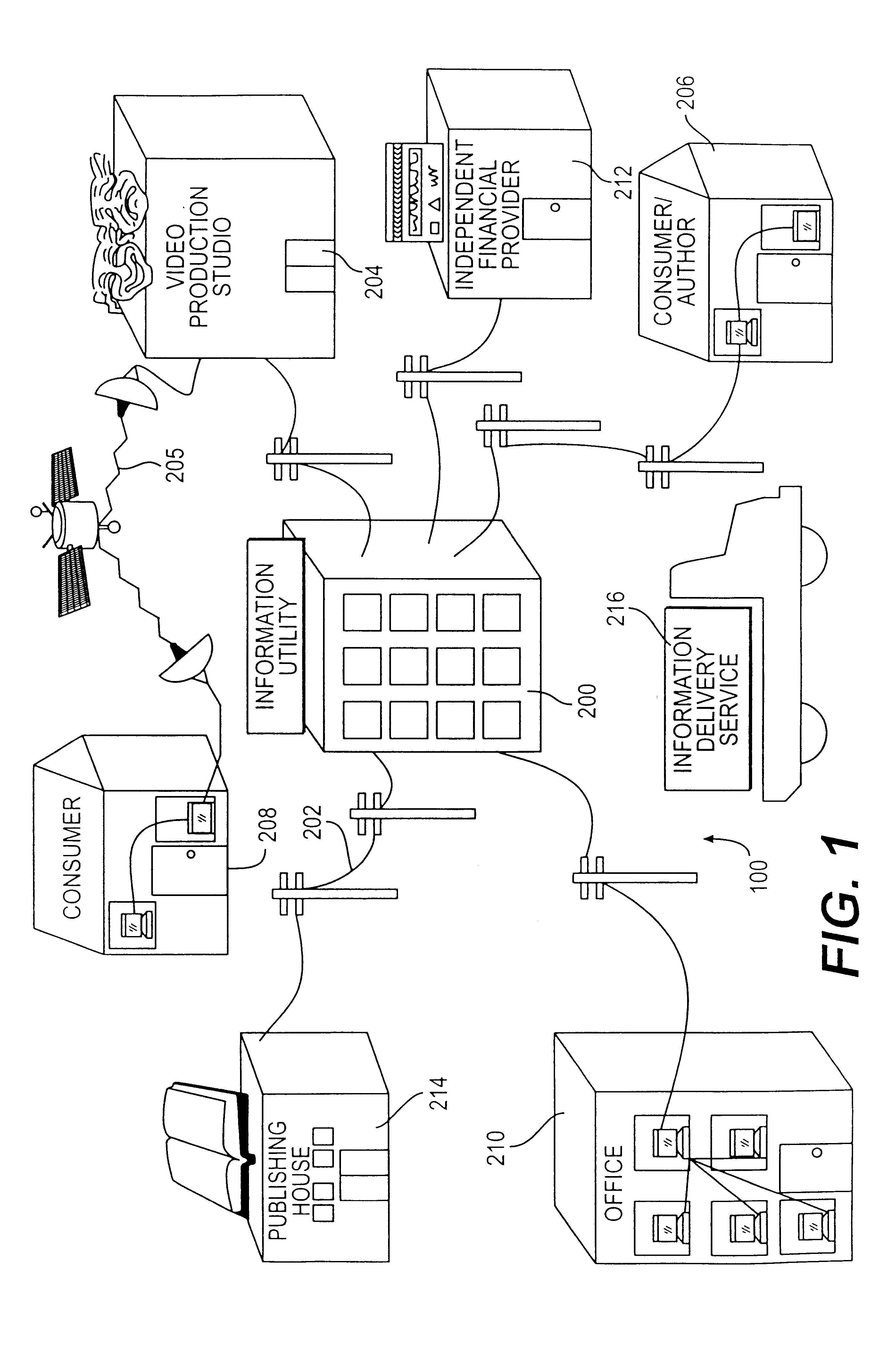

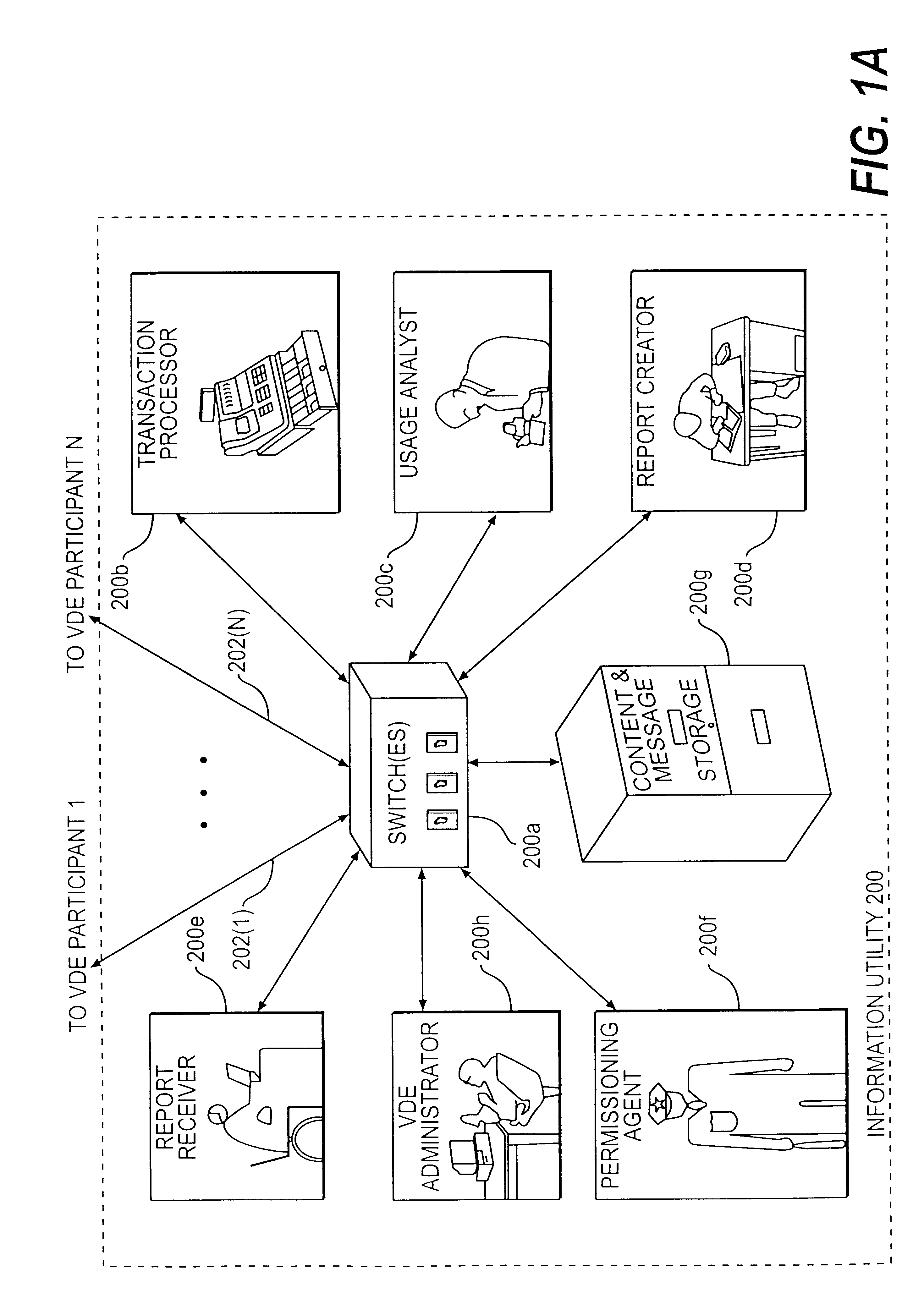

Trusted and secure techniques, systems and methods for item delivery and execution

InactiveUS6185683B2Avoid deletionEasy to identifyTelevision system detailsPulse modulation television signal transmissionDocumentation procedureDocument preparation

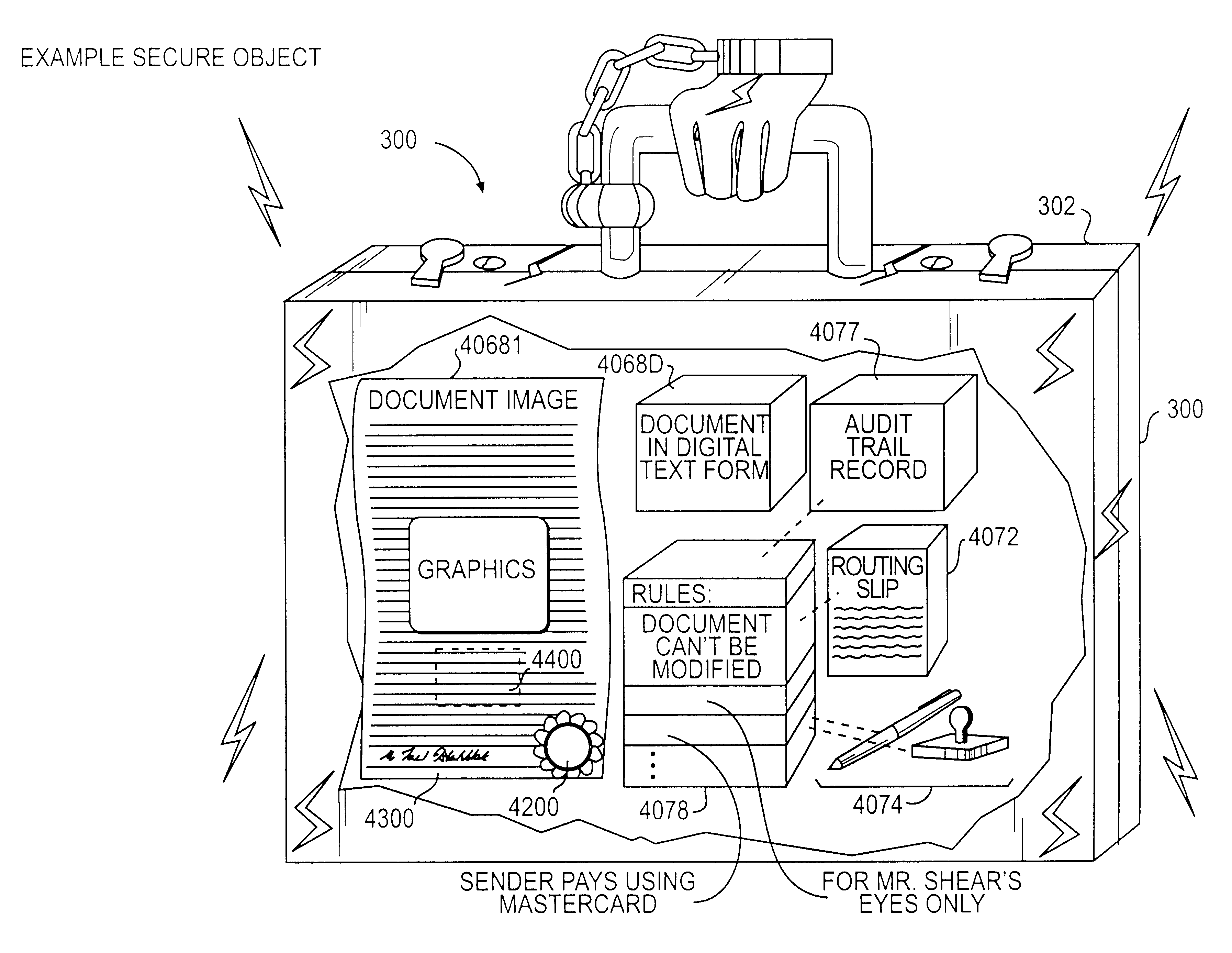

Documents and other items can be delivered electronically from sender to recipient with a level of trustedness approaching or exceeding that provided by a personal document courier. A trusted electronic go-between can validate, witness and / or archive transactions while, in some cases, actively participating in or directing the transaction. Printed or imaged documents can be marked using handwritten signature images, seal images, electronic fingerprinting, watermarking, and / or steganography. Electronic commercial transactions and transmissions take place in a reliable, "trusted" virtual distribution environment that provides significant efficiency and cost savings benefits to users in addition to providing an extremely high degree of confidence and trustedness. The systems and techniques have many uses including but not limited to secure document delivery, execution of legal documents, and electronic data interchange (EDI).

Owner:INTERTRUST TECH CORP

Portable communications device and method of use

A system, method, apparatus and computer program product for providing location based functions and mobile e-commerce comprising a central processing unit including a processor, a storage device, and programming stored in the storage device, a display device, an audio input device, an audio output device, a communications module, a commerce module, an image module, and a location module. The programming controls the operation of the present invention to provide functions based on location data, to facilitate commercial exchanges by wirelessly exchanging payment and product information with venders, to identify services such as venders meeting selection criteria, to wirelessly exchange select information with other users and systems, to restrict and / or monitor the use of the device based on authorized user parameters, to select one of a plurality networks through which to communicate, to detect a trigger for performing an action based on a change in location and sensed data, to store a voice annotation with a computer data file, to determine service providers and associated communication parameters, to contemporaneously maintain a wireless voice and data link, to provide a system for selecting mobile advertisements, and many other functions and services that are described herein.

Owner:WOUNDER

Wireless wallet

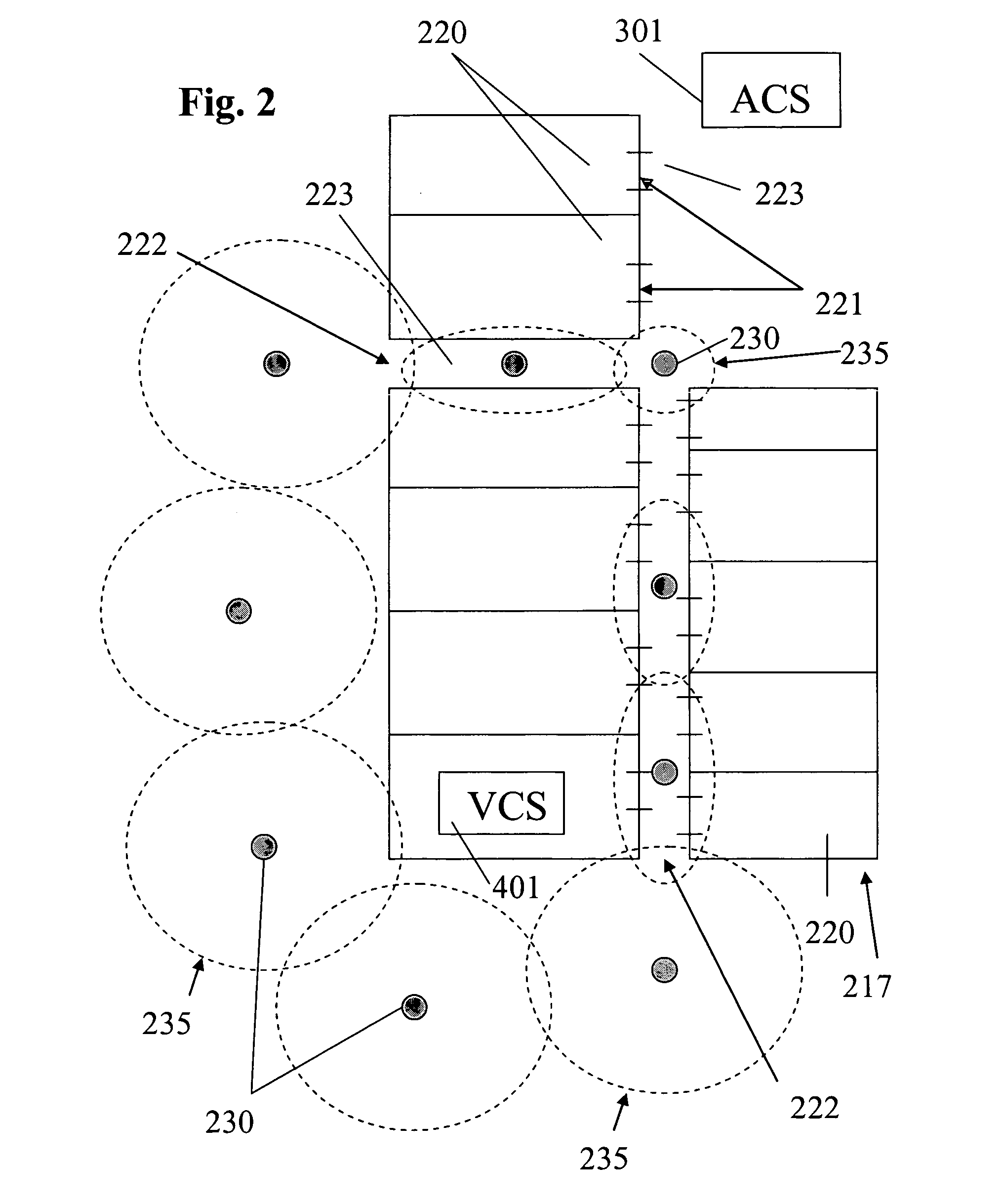

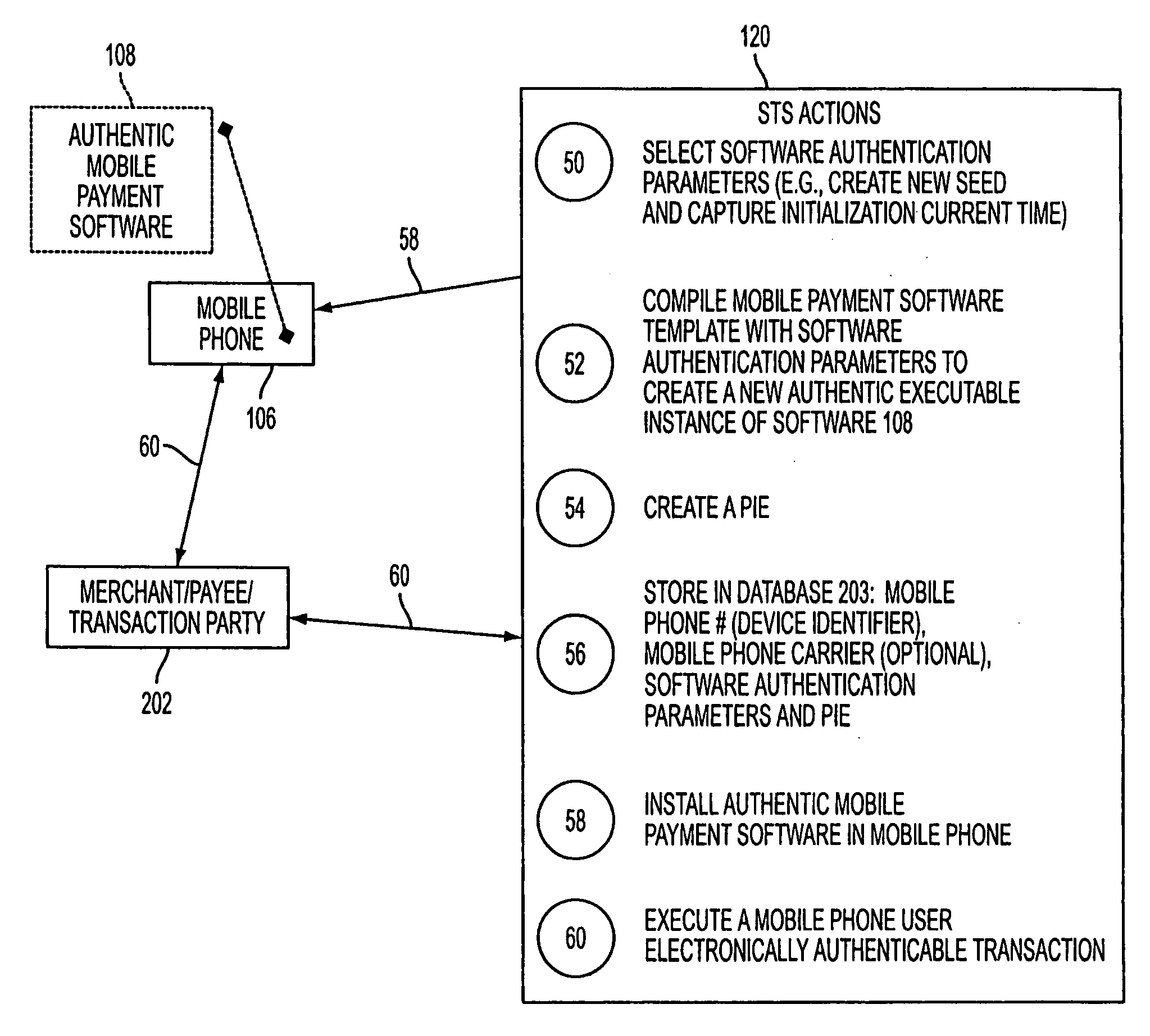

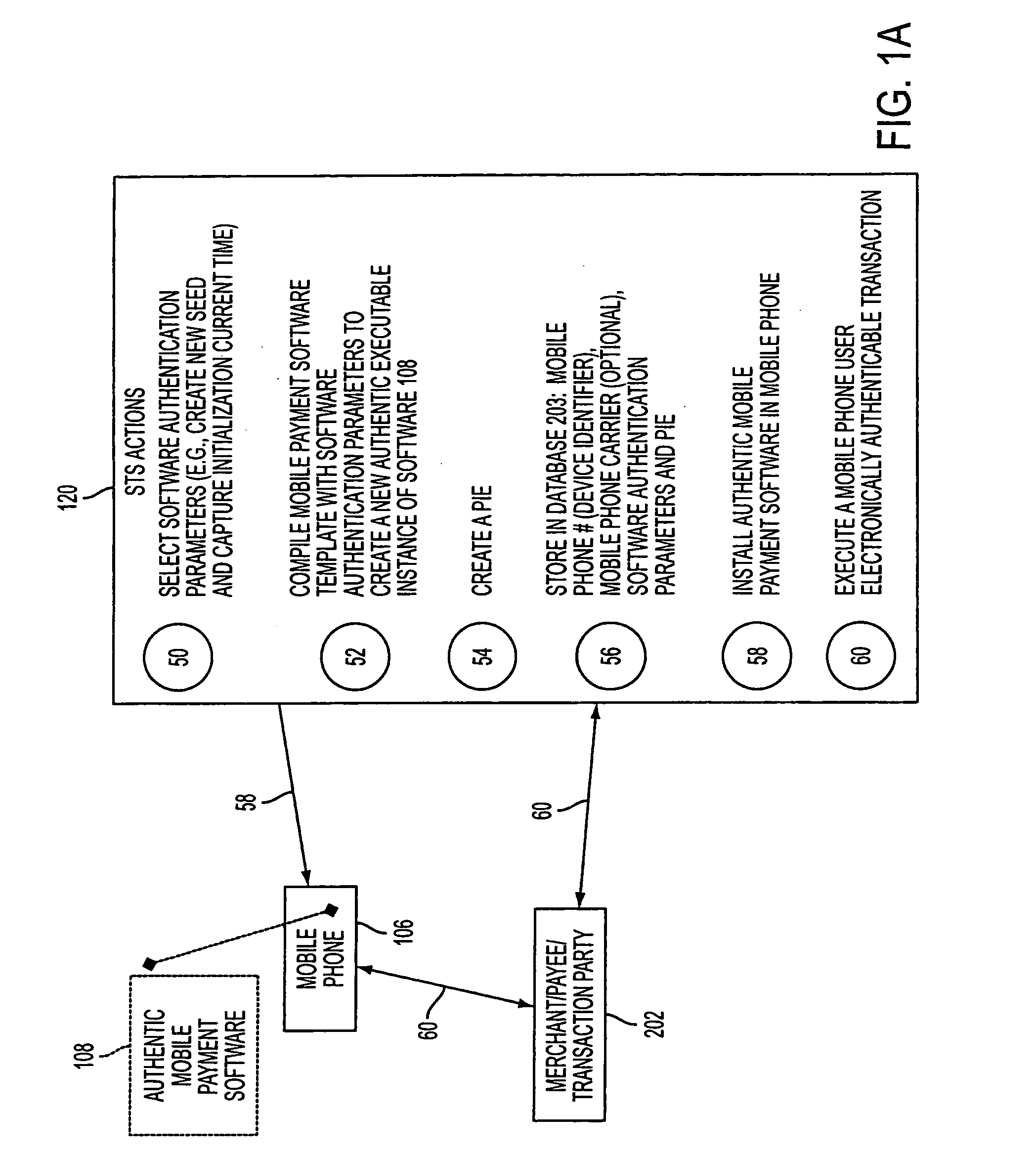

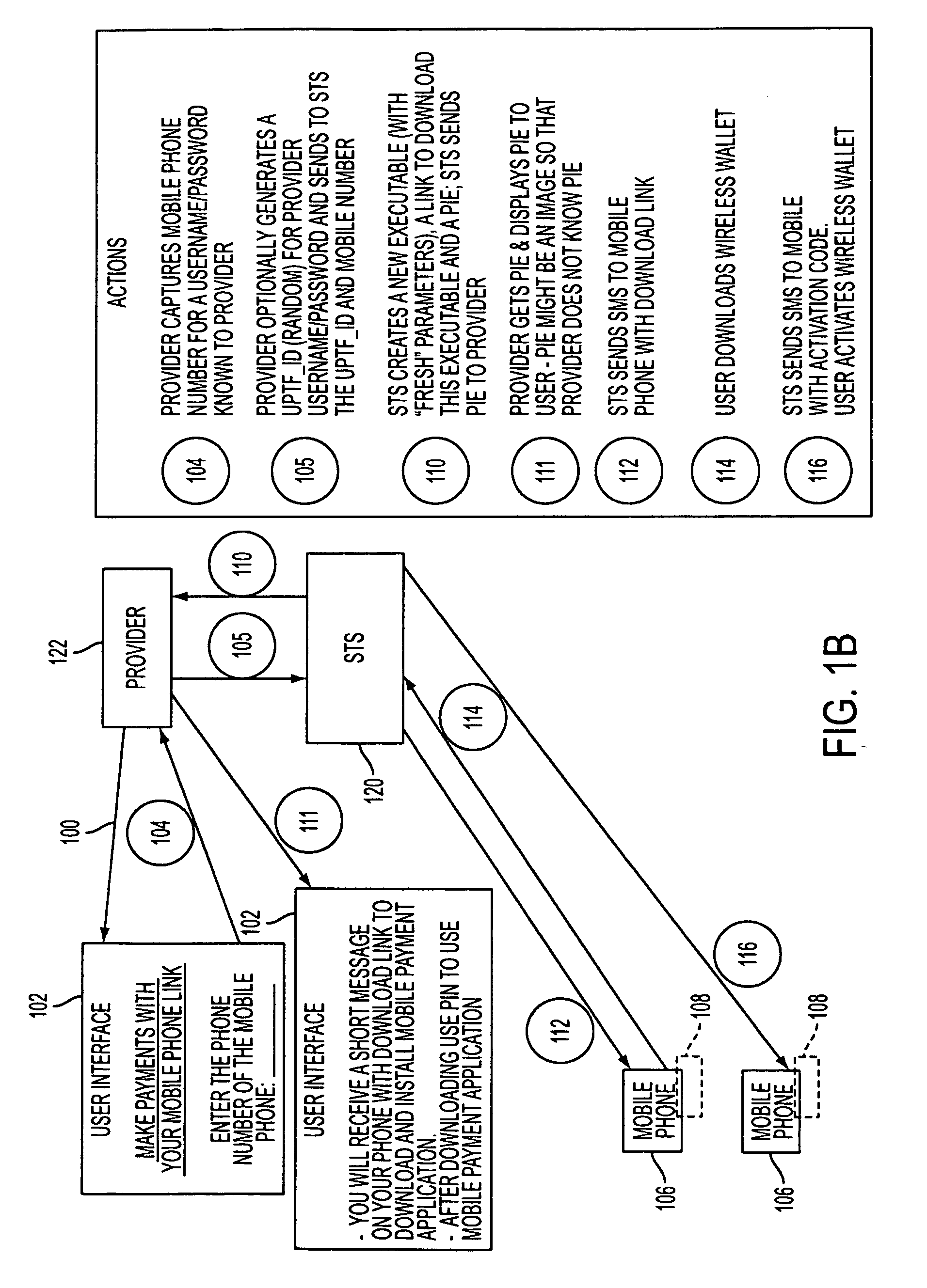

A mobile phone system and method of initializing, at a secure transaction server (STS), a mobile payment software with a software authentication parameter, as an authentic mobile payment software; providing an STS correlation between a personal identification entry (PIE) and the authentic mobile payment software; installing, in a mobile phone, the authentic mobile payment software; and inputting, by a user, the PIE to the installed authentic mobile payment software to generate according to the PIE and the software authentication parameter a transformed secure authenticable mobile phone cashless monetary transaction over the mobile phone network, as a mobile phone wireless wallet of the user of the mobile phone. The mobile phone authenticable cashless monetary transaction is performed according to an agreement view(s) protocol.

Owner:PCMS HOLDINGS INC

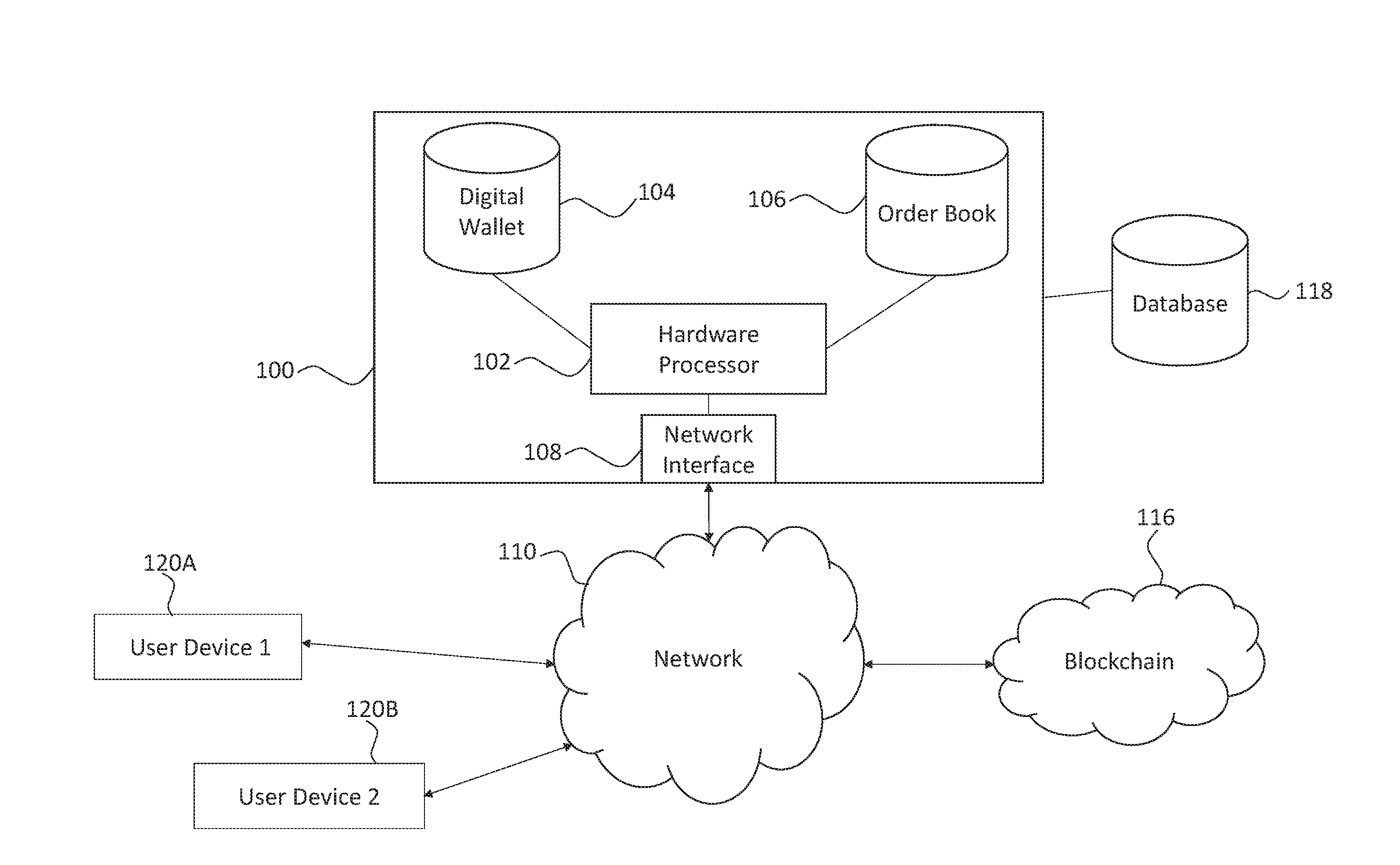

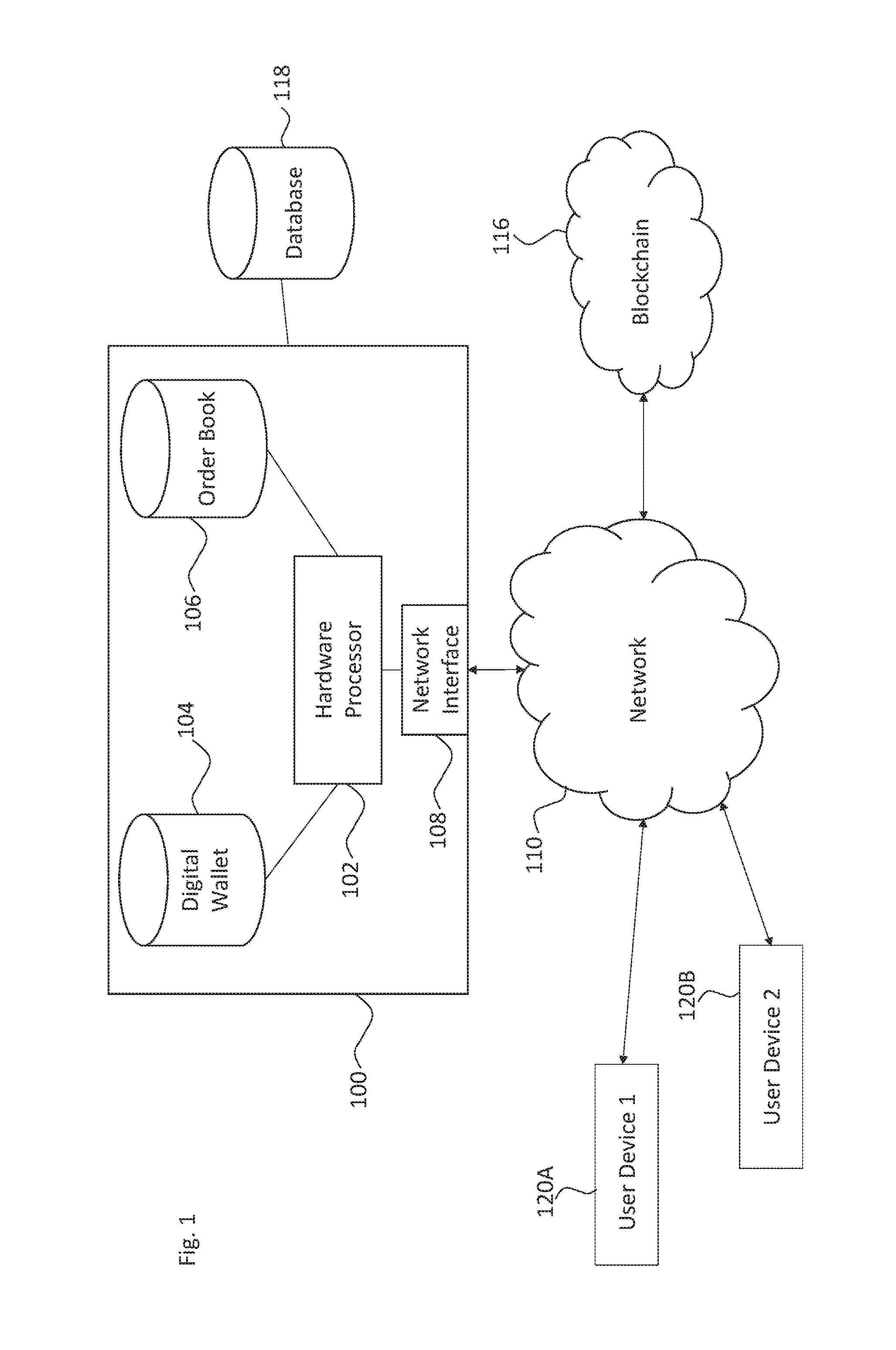

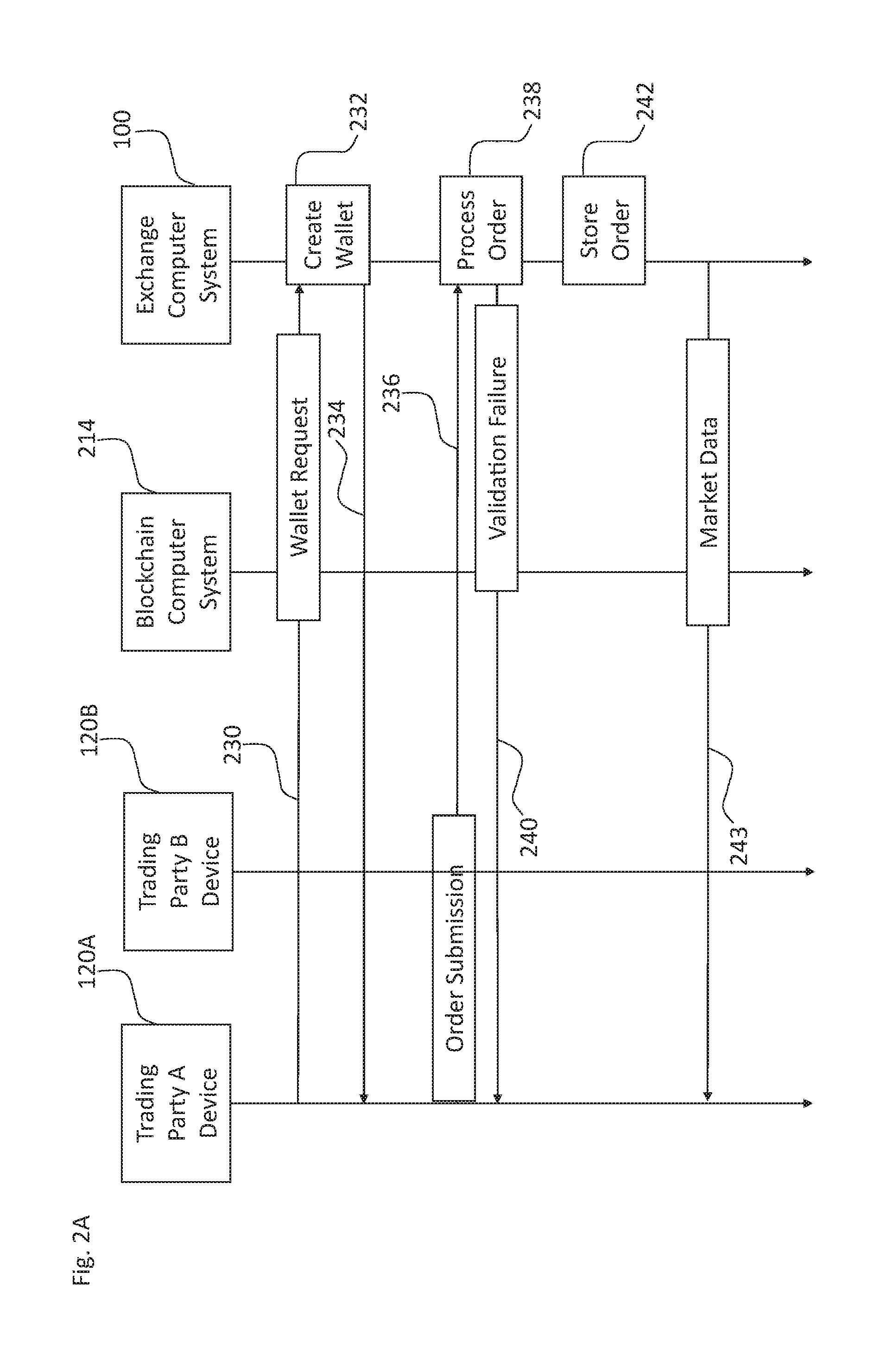

Systems and methods of blockchain transaction recordation

Owner:NASDAQ INC

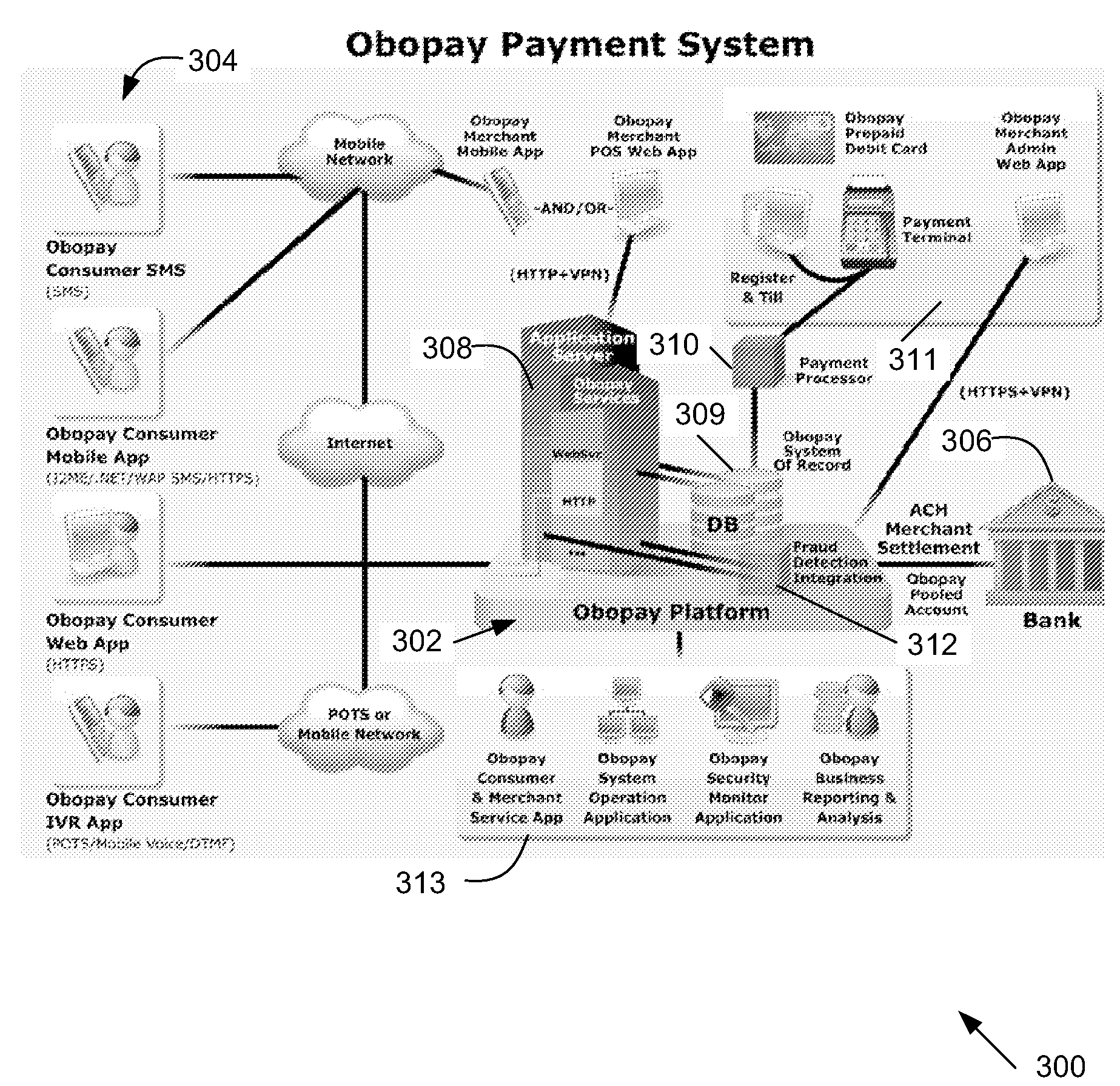

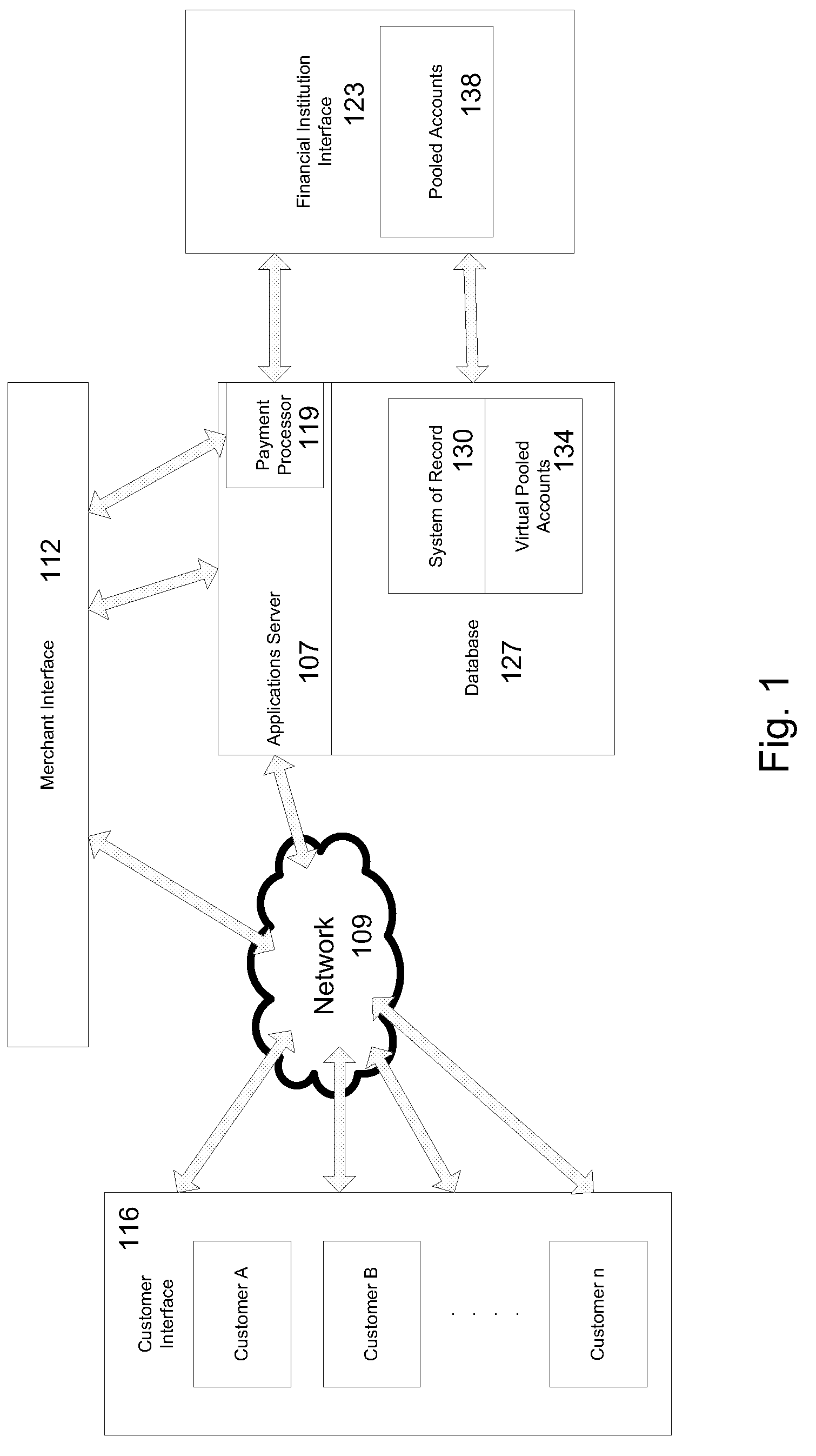

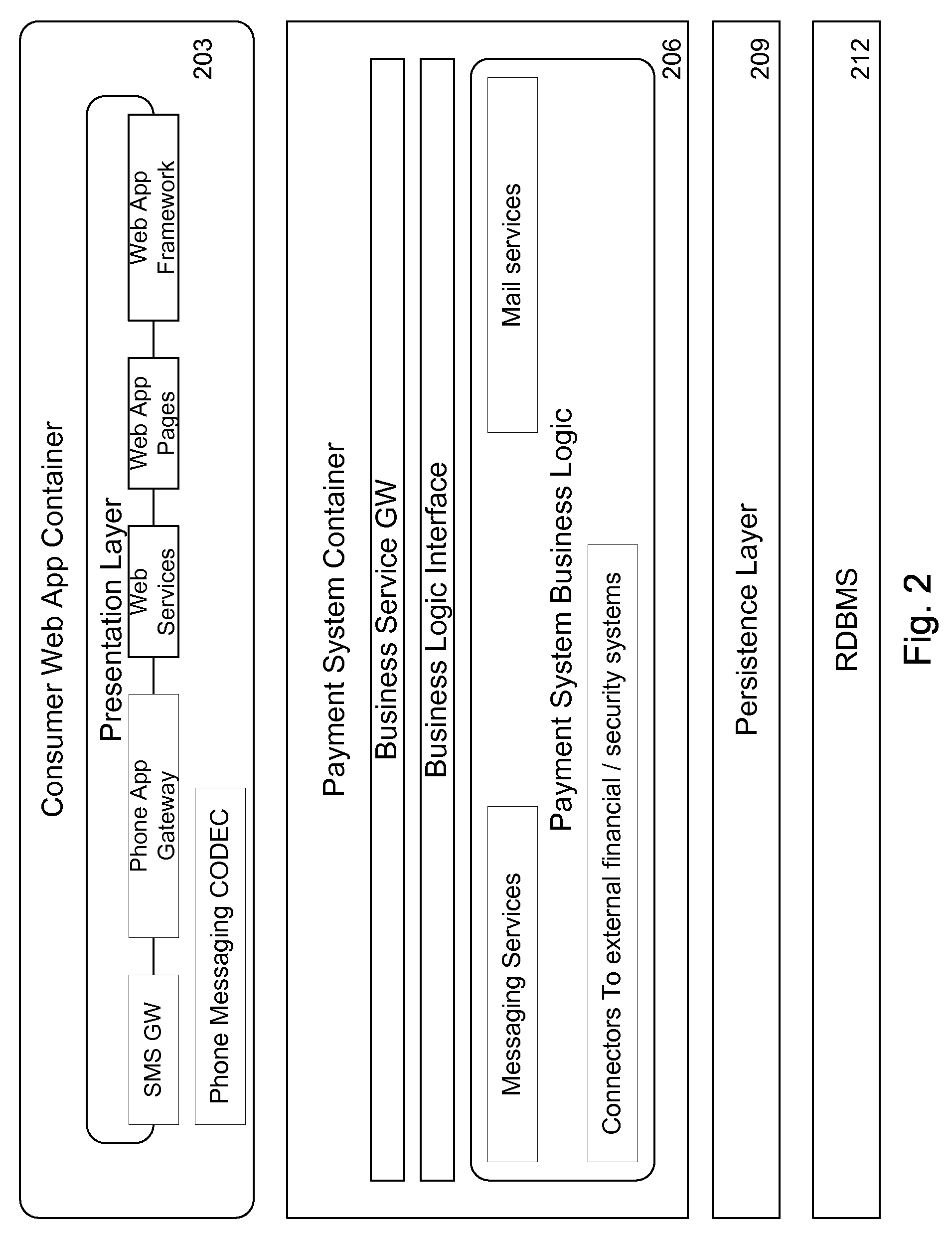

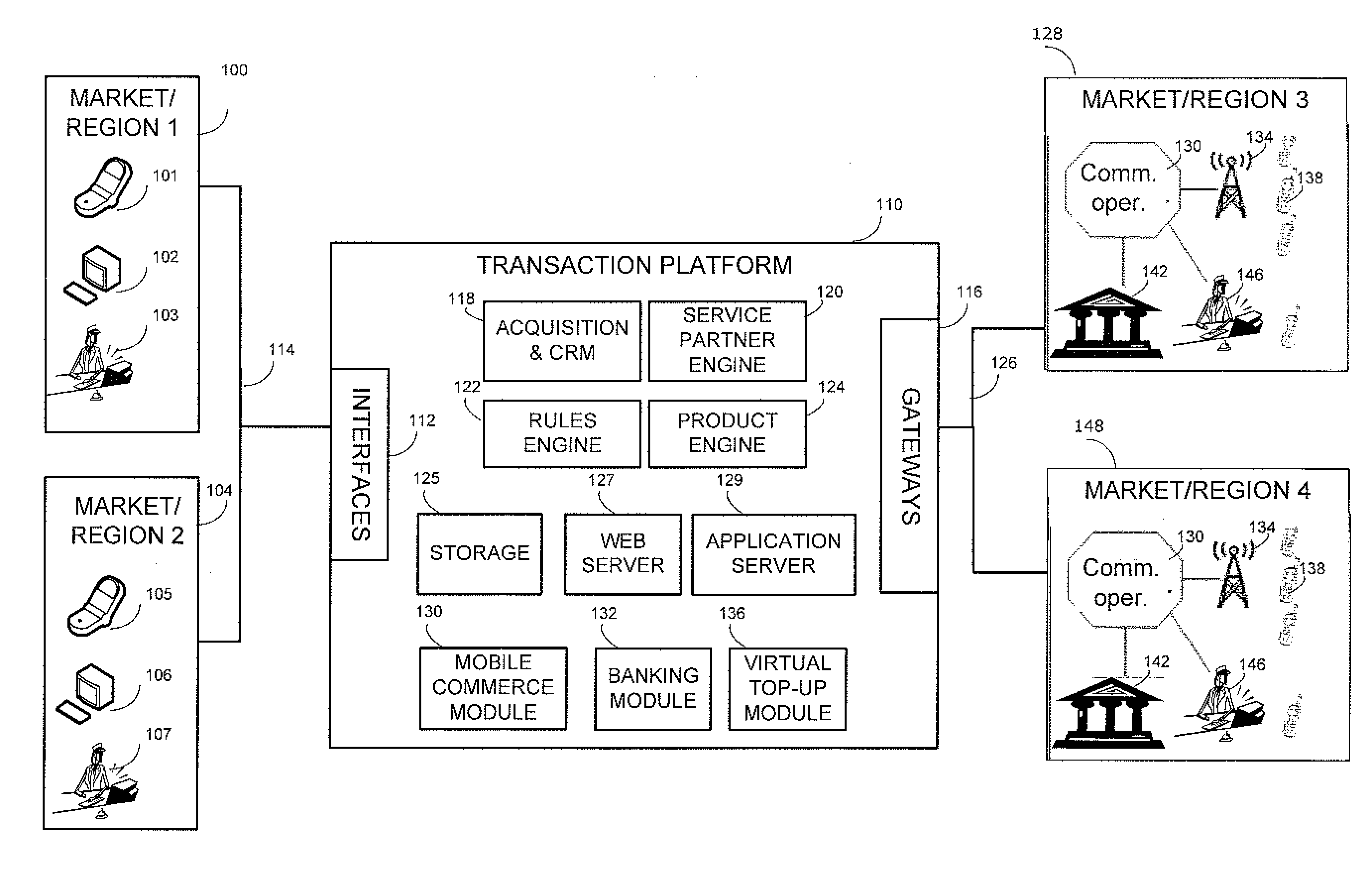

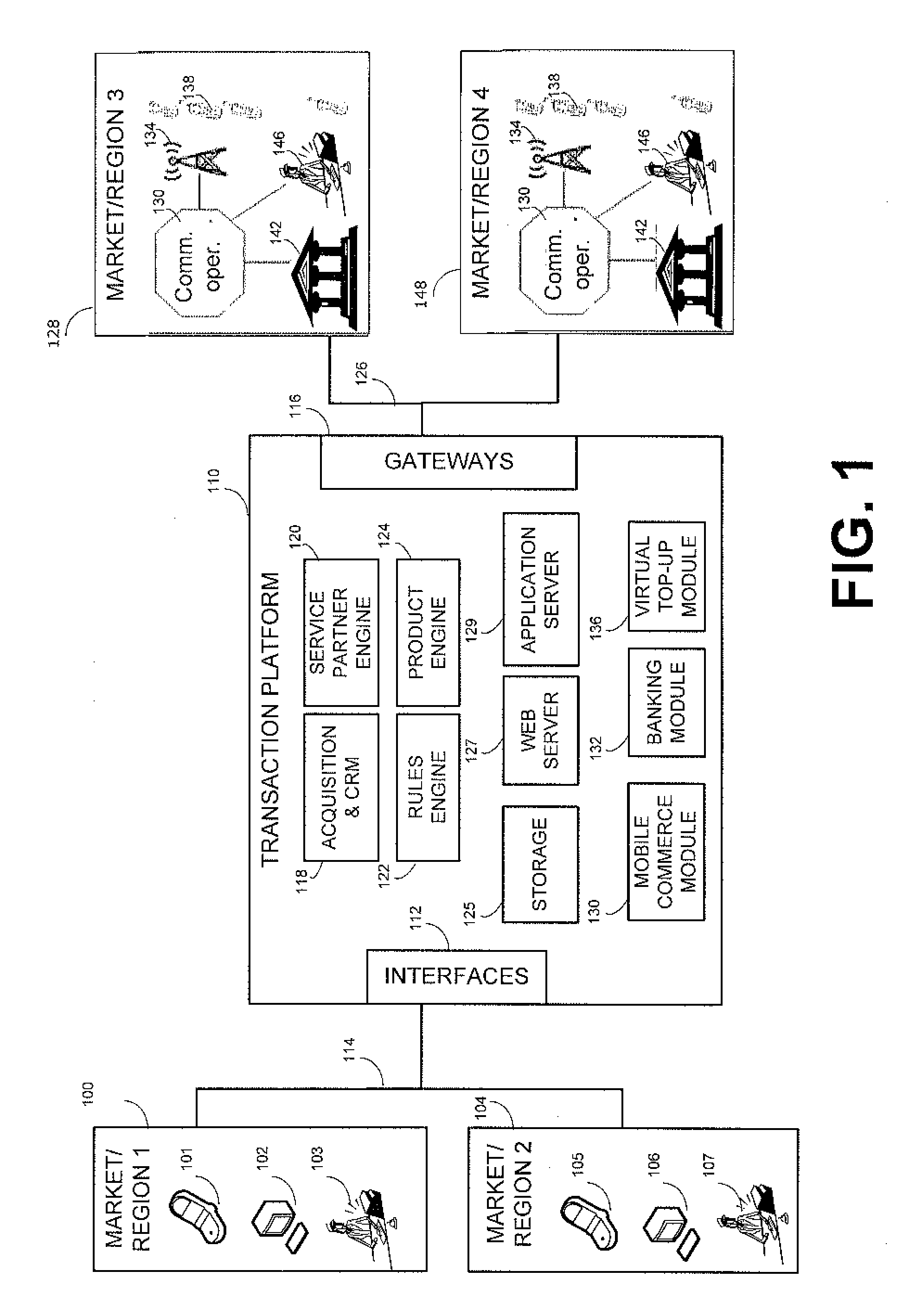

Virtual Pooled Account for Mobile Banking

InactiveUS20090119190A1Reduce settlementReduce operating costsComplete banking machinesFinanceOperational costsSimulation

A virtual pooled account is used in operating a system having multiple financial partners. In a specific implementation, the system is a mobile banking system. Instead of maintaining separate general ledgers for each financial institution, the system will keep one general virtual pooled account. This will reduce the settlement and operational costs of the system. The owner of the virtual pooled account will receive the float on the virtual pooled account, and this float will be distributed to the multiple financial partners according to a formula.

Owner:OBOPAY MOBILE TECH INDIA PTE LTD

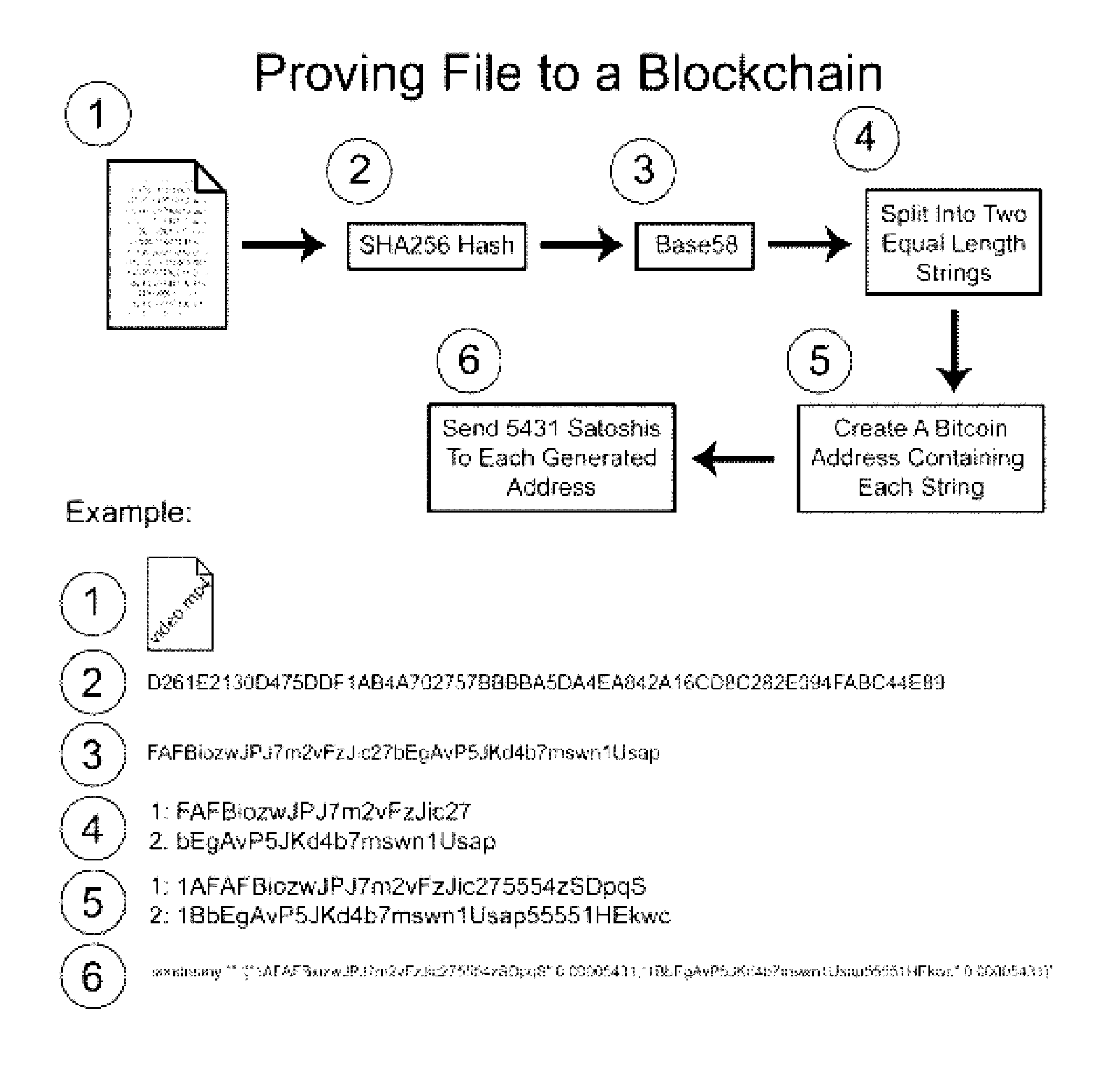

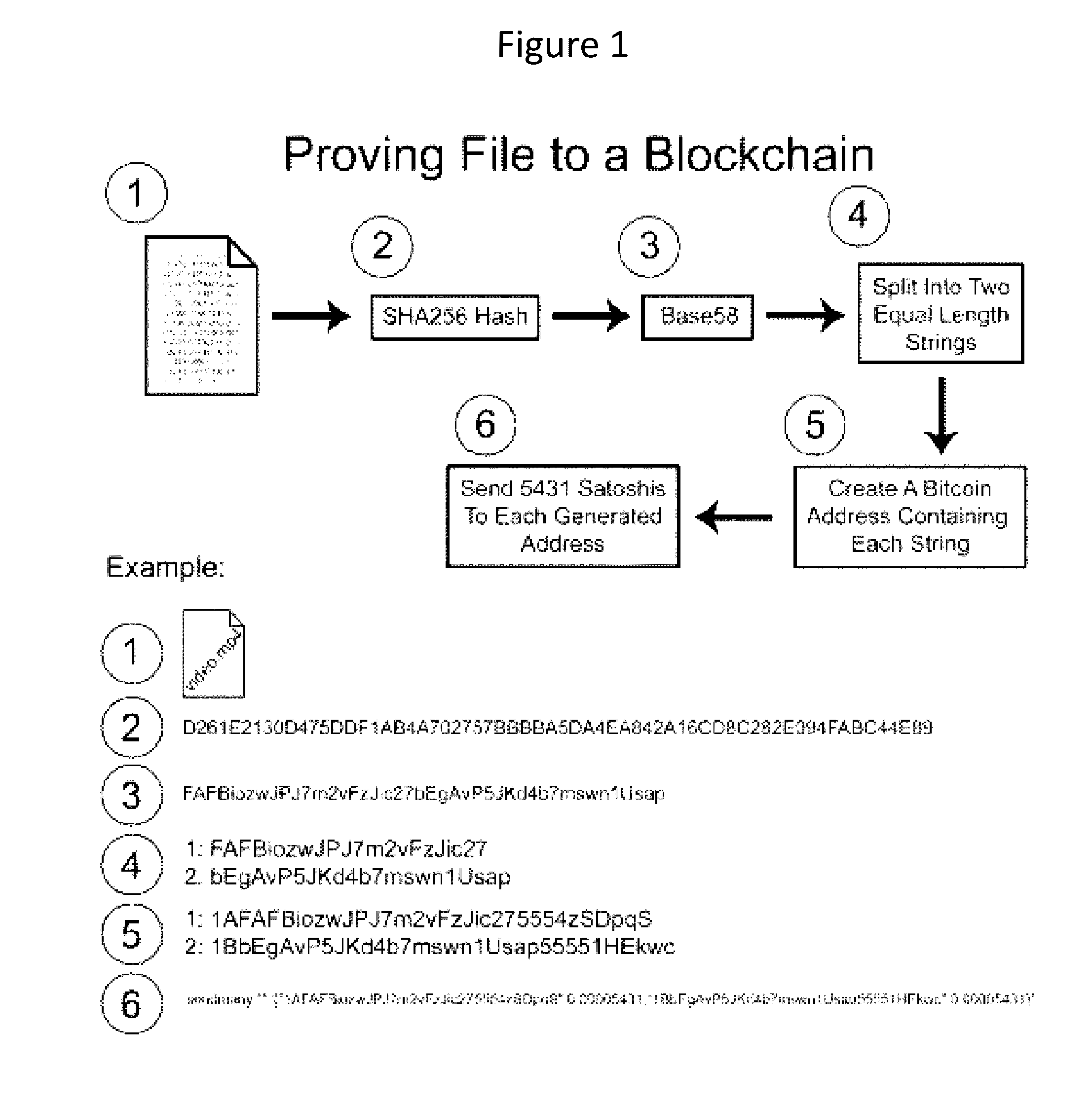

Authentication and verification of digital data utilizing blockchain technology

InactiveUS20160283920A1Key distribution for secure communicationEncryption apparatus with shift registers/memoriesDigital dataHuman interaction

A method for authenticating a chain of custody utilizing blockchain technology, whereby digital evidence or other digital content is acquired and then hashed to produce a hash fingerprint / signature and then immediately or instantly submitting said hash fingerprint / signature to the blockchain using the blockchain network protocol, forming an immediate verifiable chain of custody without human interaction or requiring a trusted third party.

Owner:FISHER JUSTIN +1

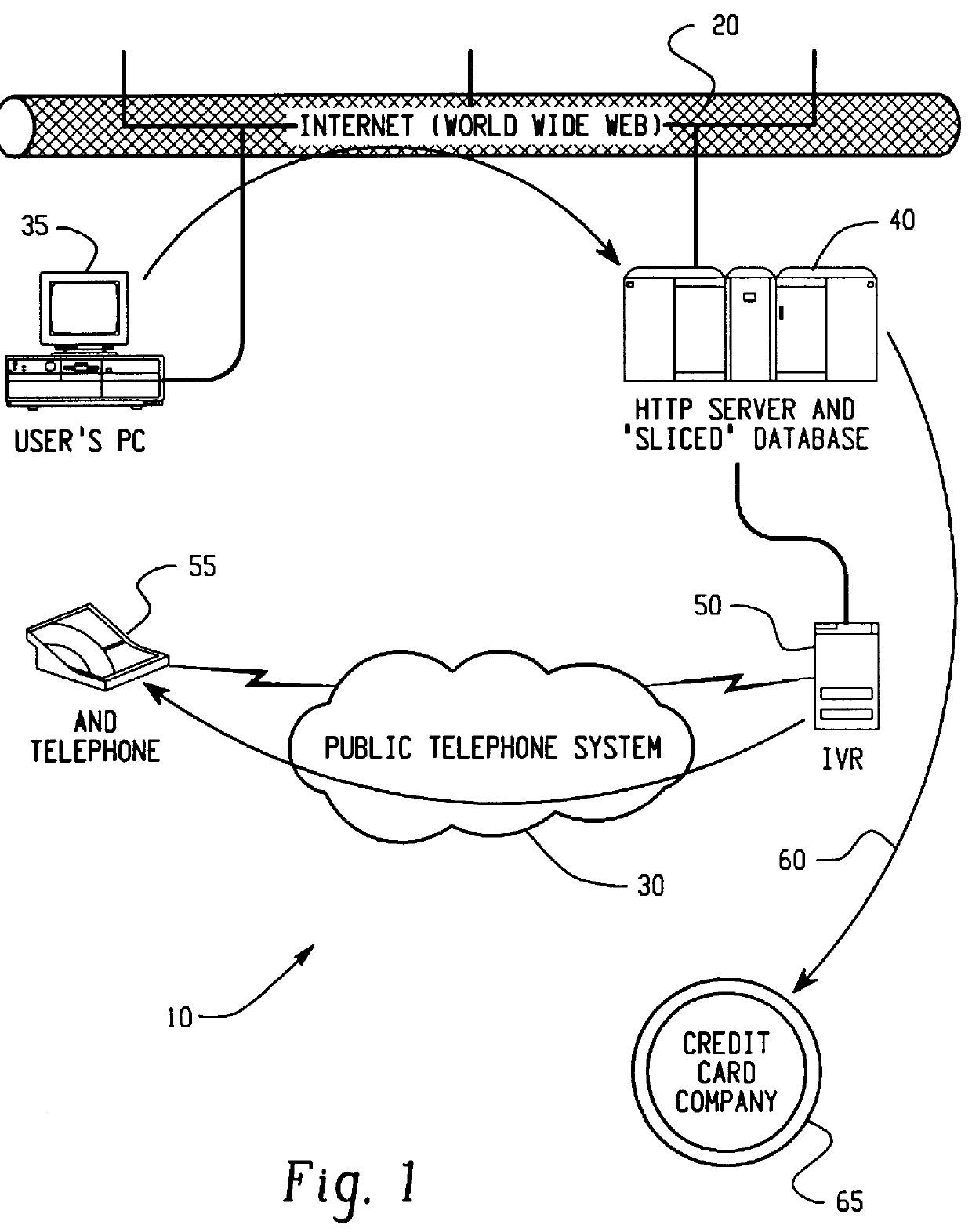

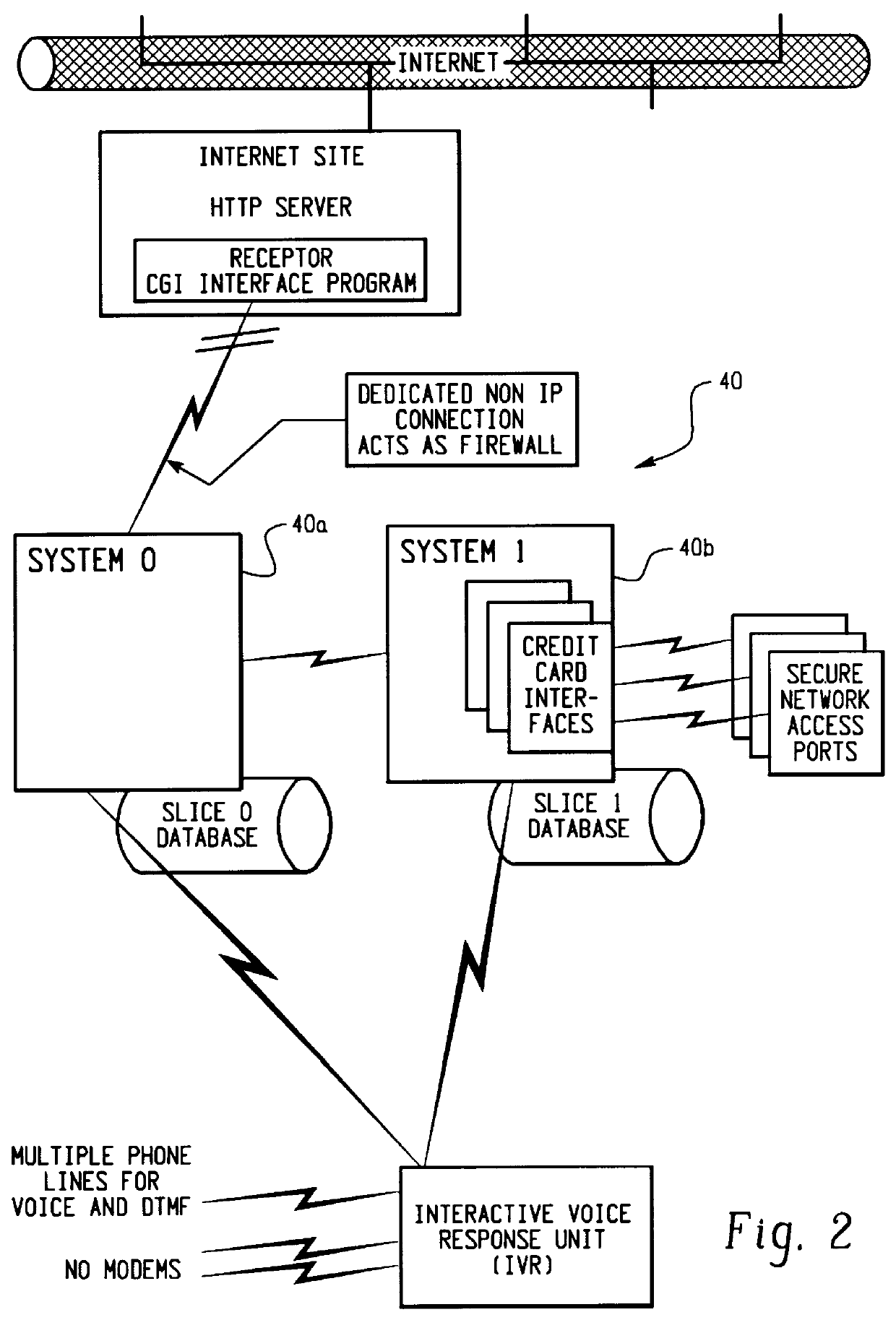

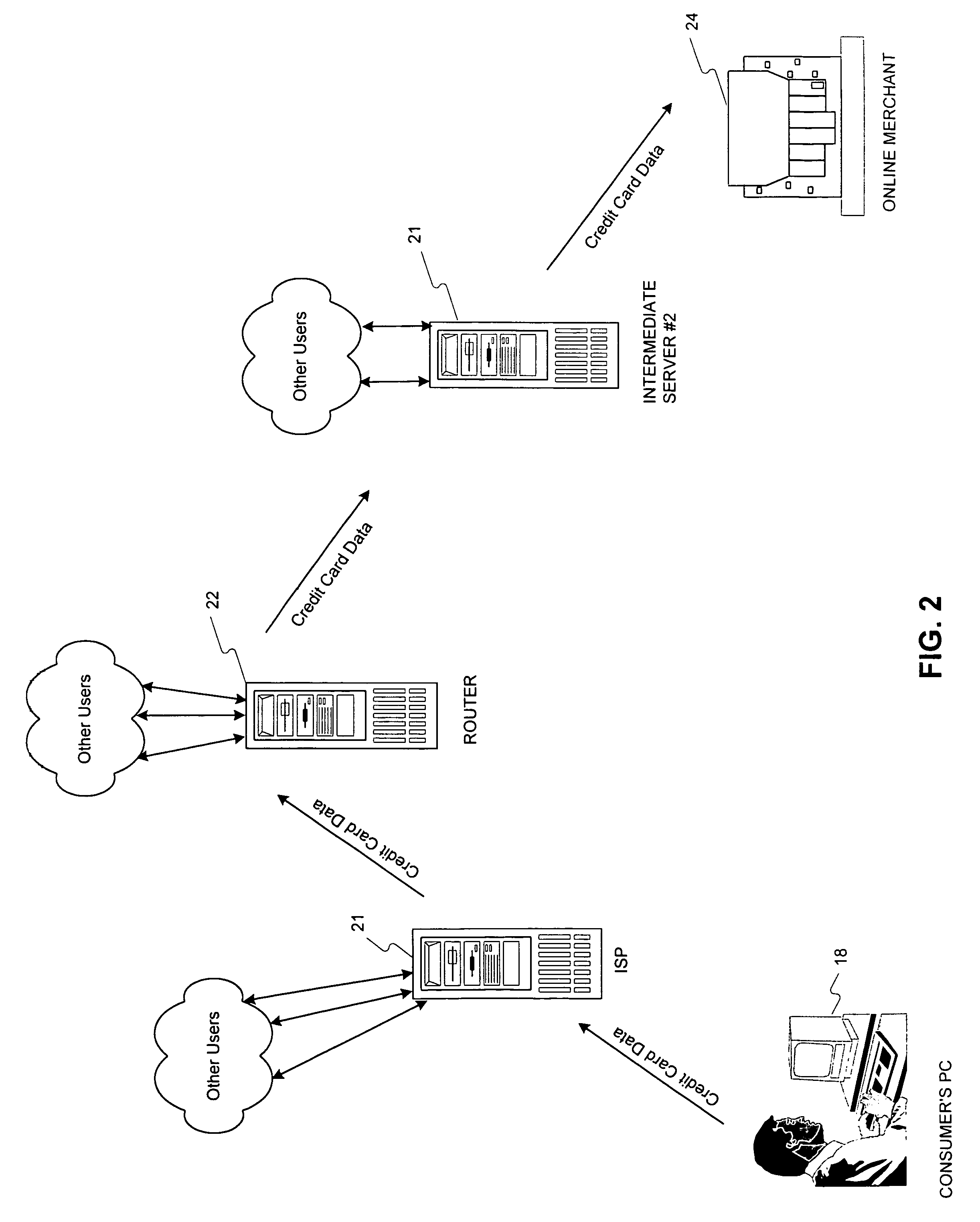

Transaction security method and apparatus

A method for performing secure transactions, such as credit card purchases, using two or more non-secure networks (such as the Internet and the public telephone system) in such a way that security is insured. A person wishing to initiate a secure transaction sends a message over one of the non-secure networks to a computer. That computer automatically uses the second non-secure network to contact the person back to verify the transaction. The call-back mechanism employs a method to authenticate the identity or authority of the person initiating the transaction. No single wire-tapping or network snooping device sees the entire transaction. No single database contains the entire set of information.

Owner:PICKETT THOMAS E

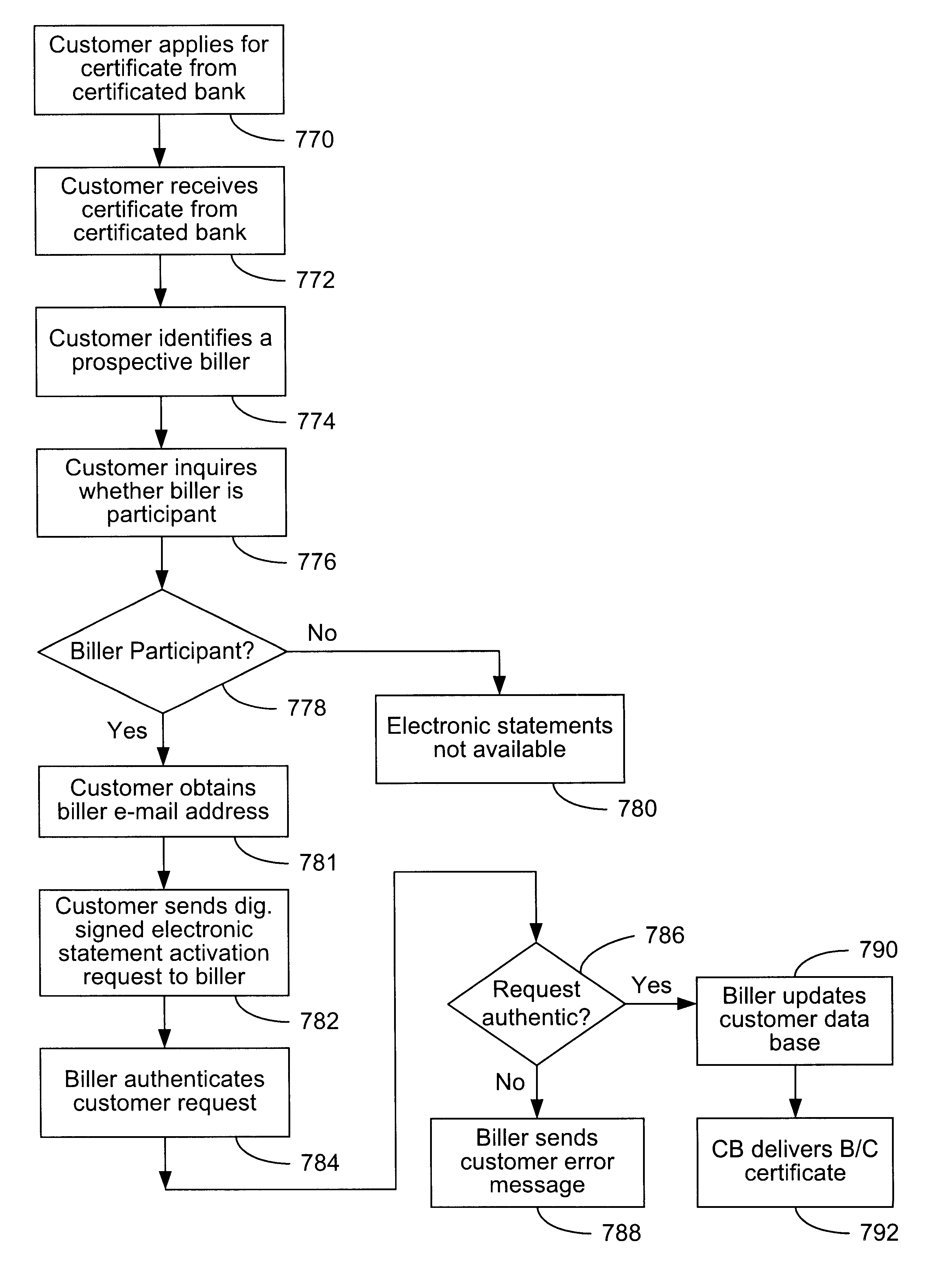

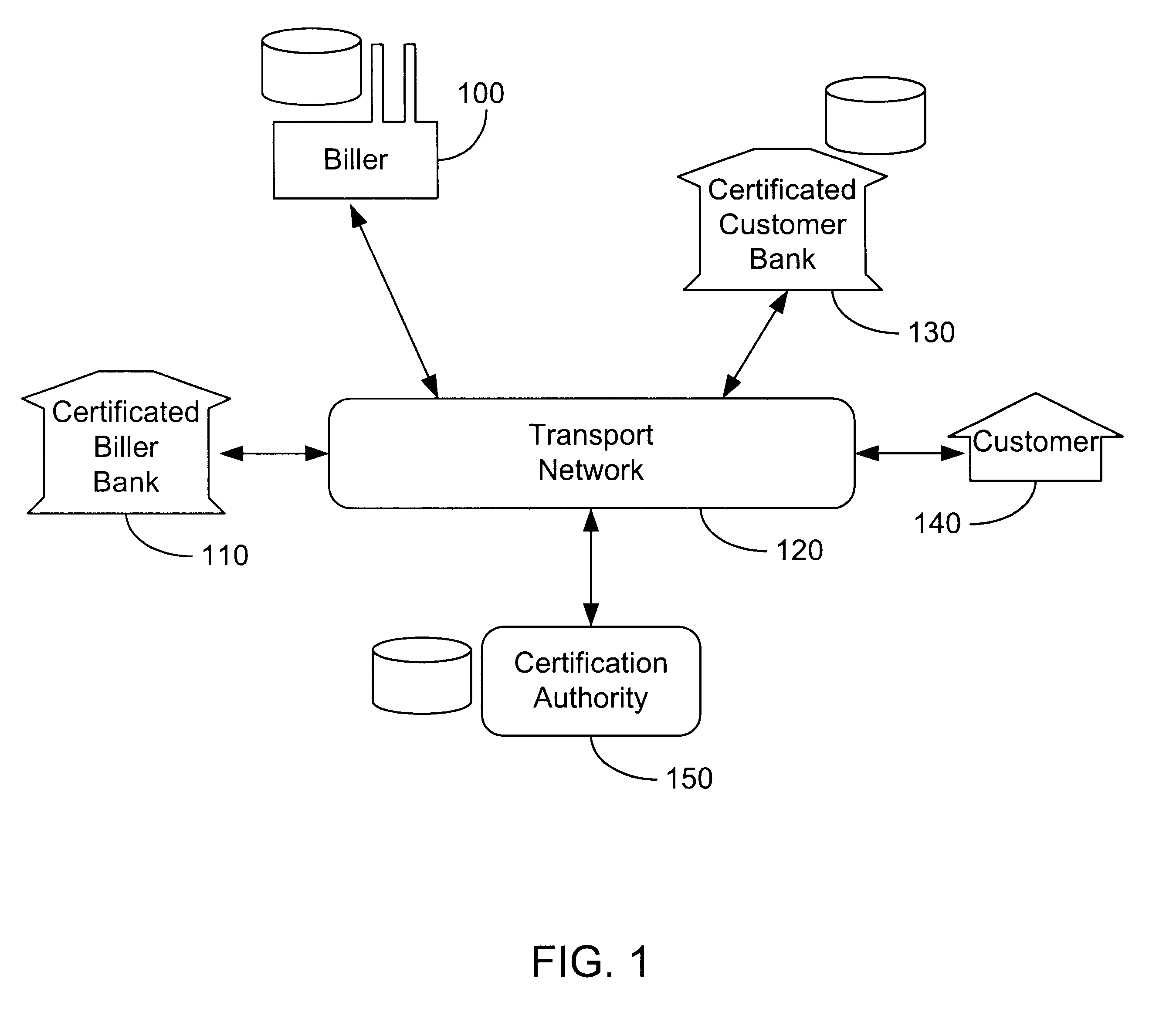

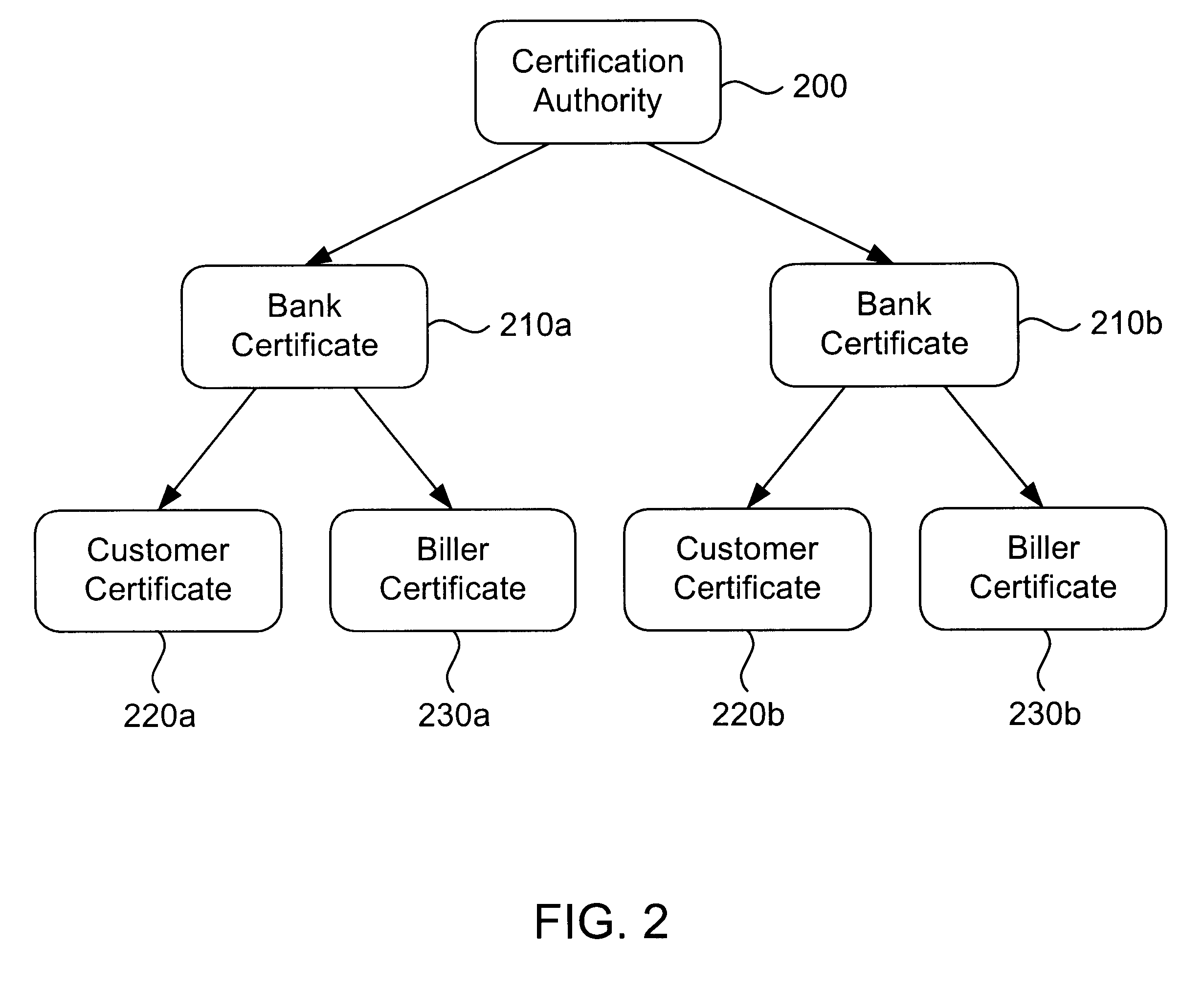

Secure interactive electronic account statement delivery system

InactiveUS6285991B1Good flexibilityBilling is thereby complicatedFinanceUser identity/authority verificationDigital dataNetwork communication

The present invention consists of a secure interactive electronic account statement delivery system suitable for use over open networks such as the Internet. The invention utilizes a certification hierarchy to insure that electronic bills, invoices, and other account statements can be securely sent over open networks. The participants in the system are a certification authority, certificated banks, billers, and customers. The certification authority grants digital certificates to the certificated banks, which in turn grant digital certificates to billers and customers. Digital certificates form the basis for encryption and authentication of network communications, using public and private keys. The certificates associate a customer and biller with a certificated bank and with the electronic billing system, much like payment cards associate a customer with a payment card issuer and a particular payment card system. Digital signatures are used for authentication and non-repudiation. The certificates may be stored as digital data on storage media of a customer's or biller's computer system, or may be contained in integrated circuit or chip cards physically issued to billers and customers. The electronic bill itself may be a simple text message containing the equivalent of summary information for the bill, or may be more elaborate. In one embodiment of the invention, the electronic bill contains a number of embedded links, for example an embedded URL of a biller's world wide web server that allows the customer to interactively bring up detailed billing information by activating the link. The e-mail message may also include links to third party websites.

Owner:VISA INT SERVICE ASSOC

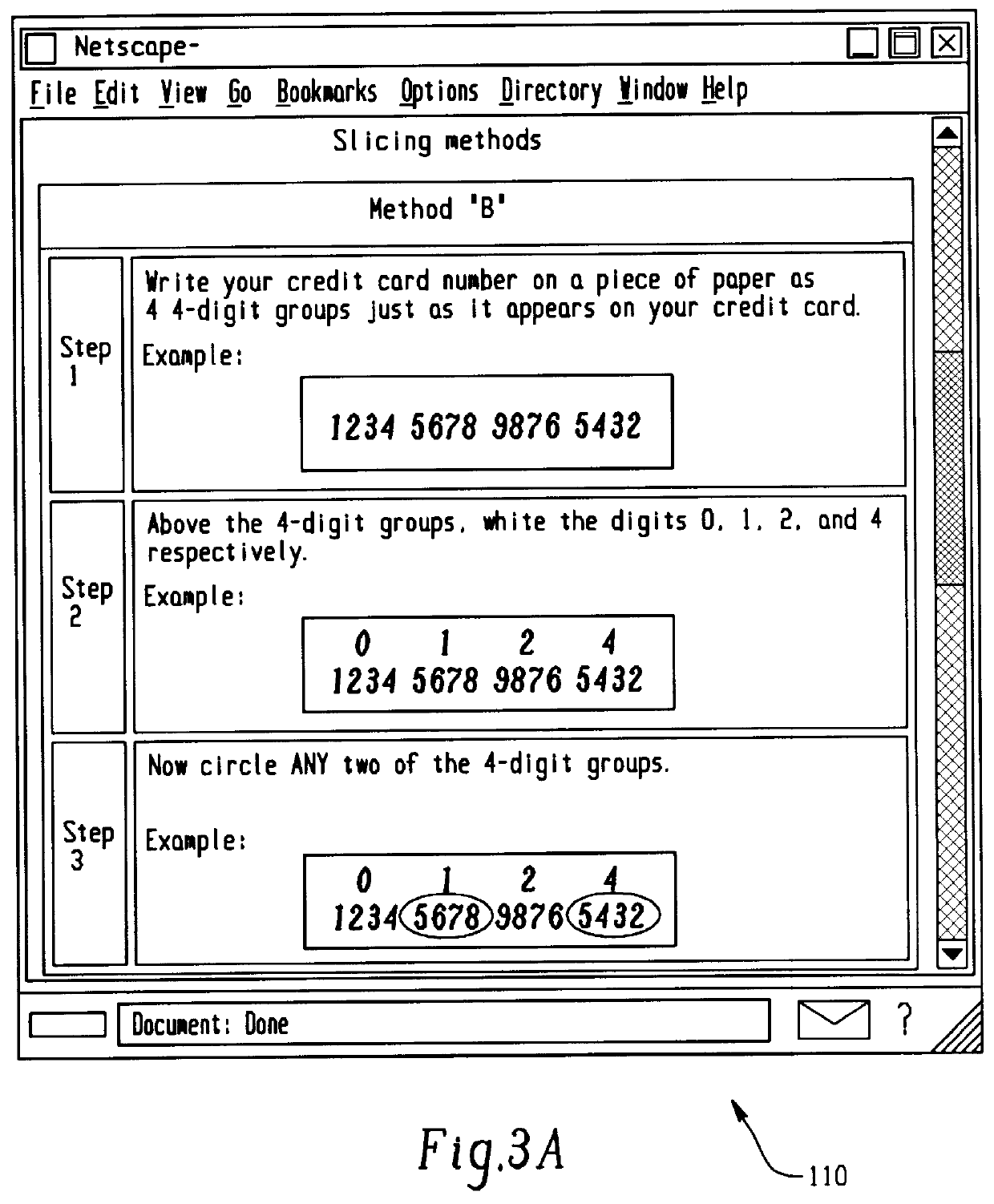

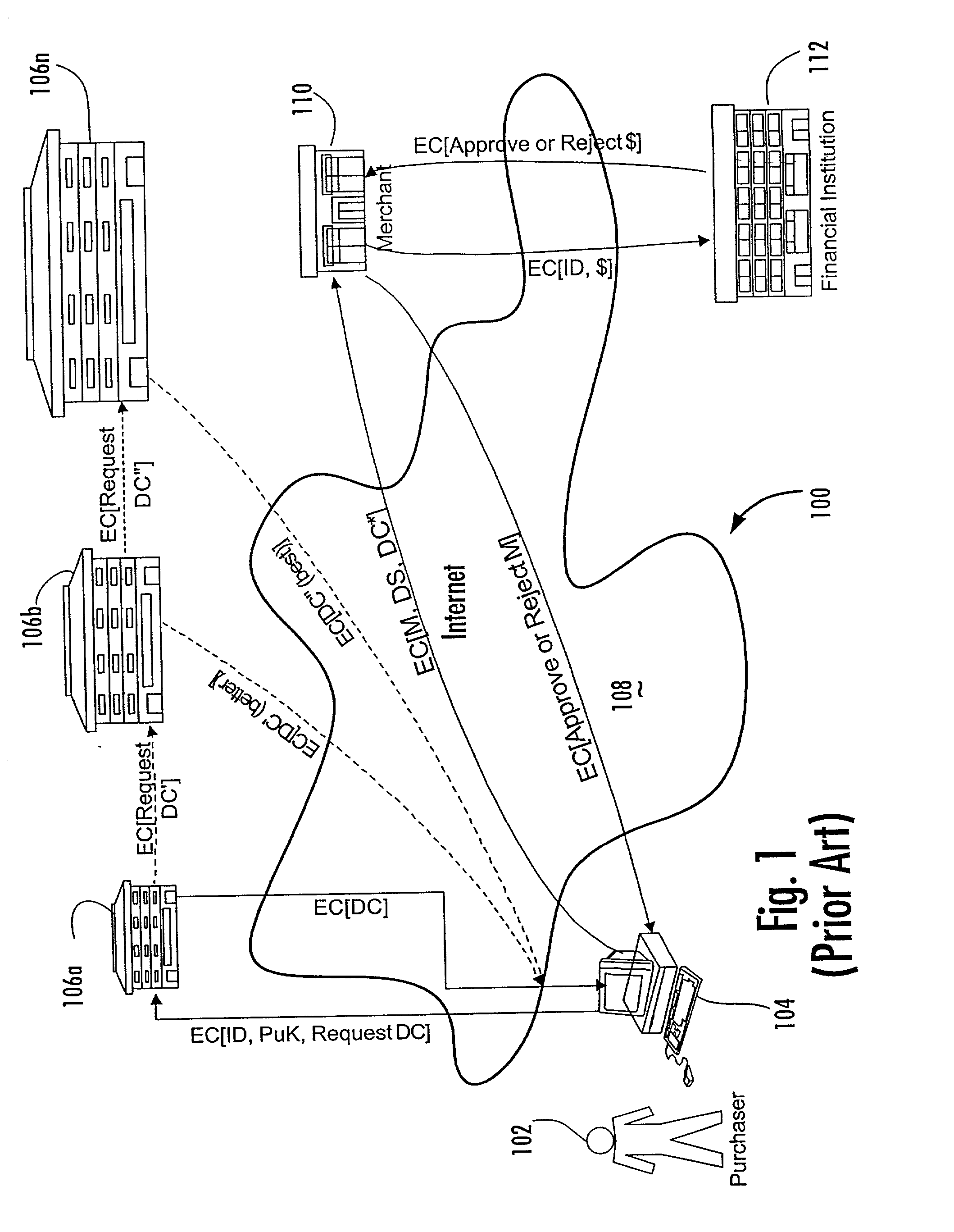

Methods for purchasing of goods and services

InactiveUS7349871B2Risk minimizationReducing credit card fraudPayment circuitsElectronic credentialsThird partyPurchasing

Owner:PCMS HOLDINGS INC

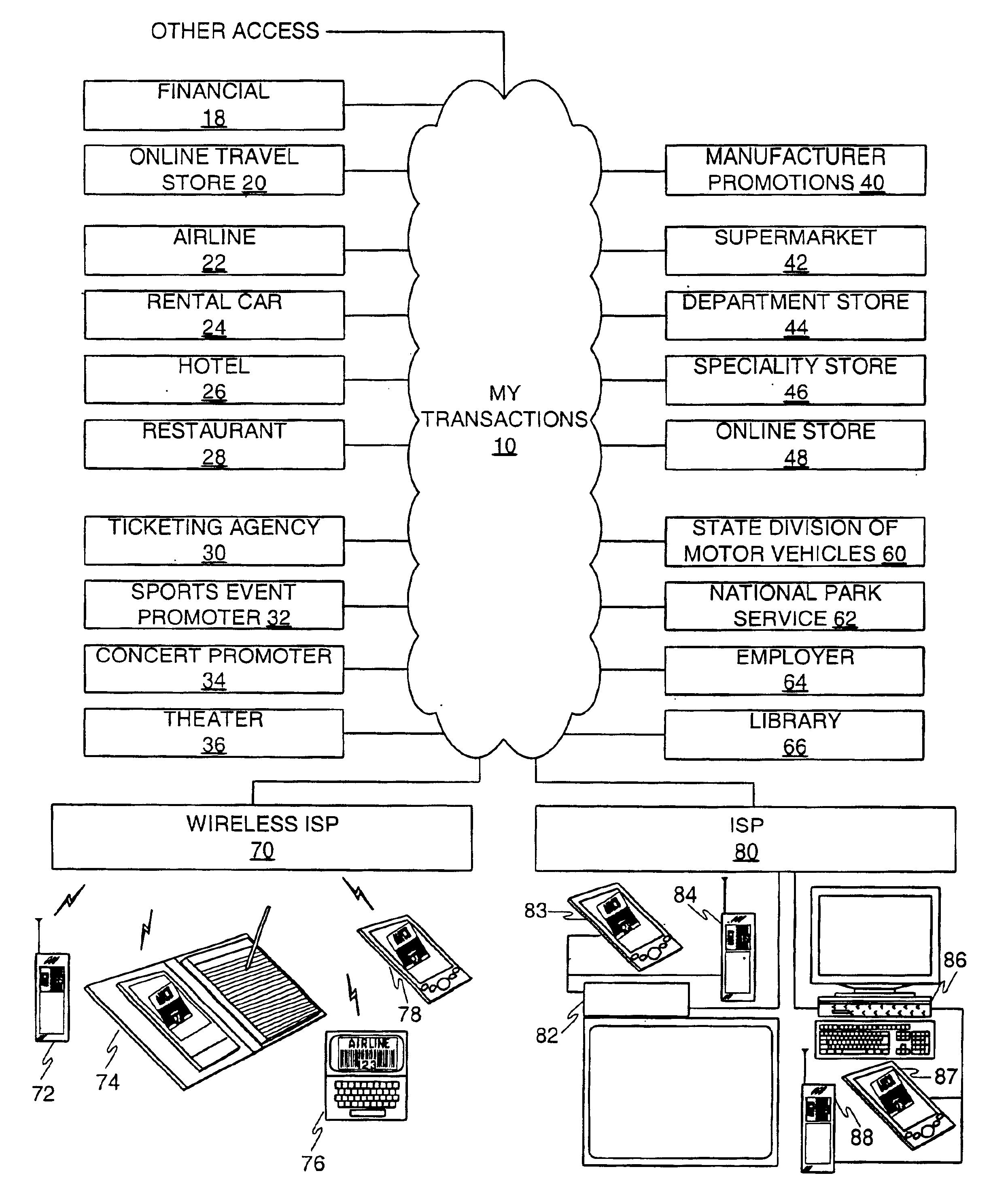

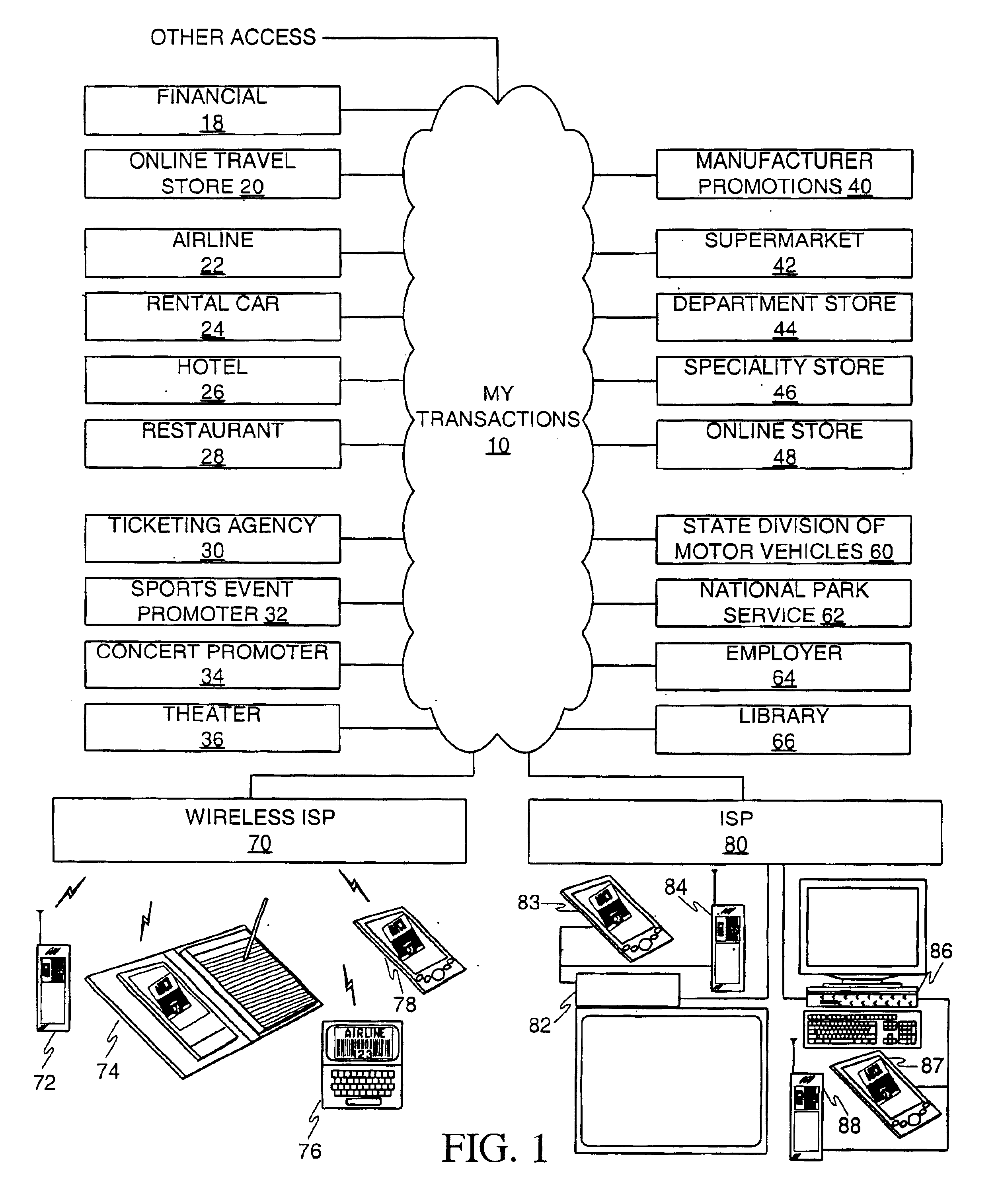

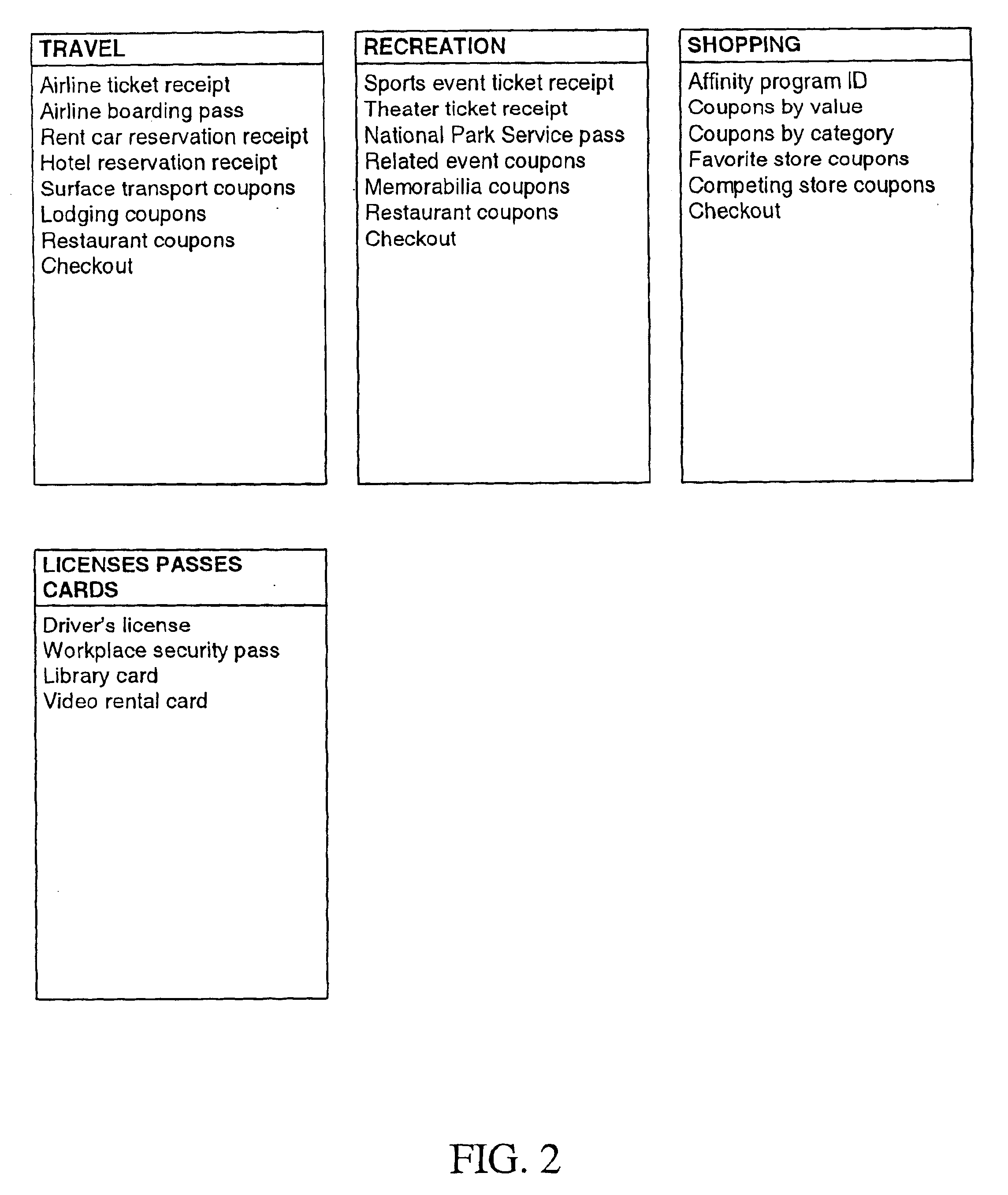

Method and apparatus for acquiring, maintaining, and using information to be communicated in bar code form with a mobile communications device

InactiveUS6736322B2Convenient acquisition and maintenance and useCharacter and pattern recognitionIndividual entry/exit registersBarcodeCommunication device

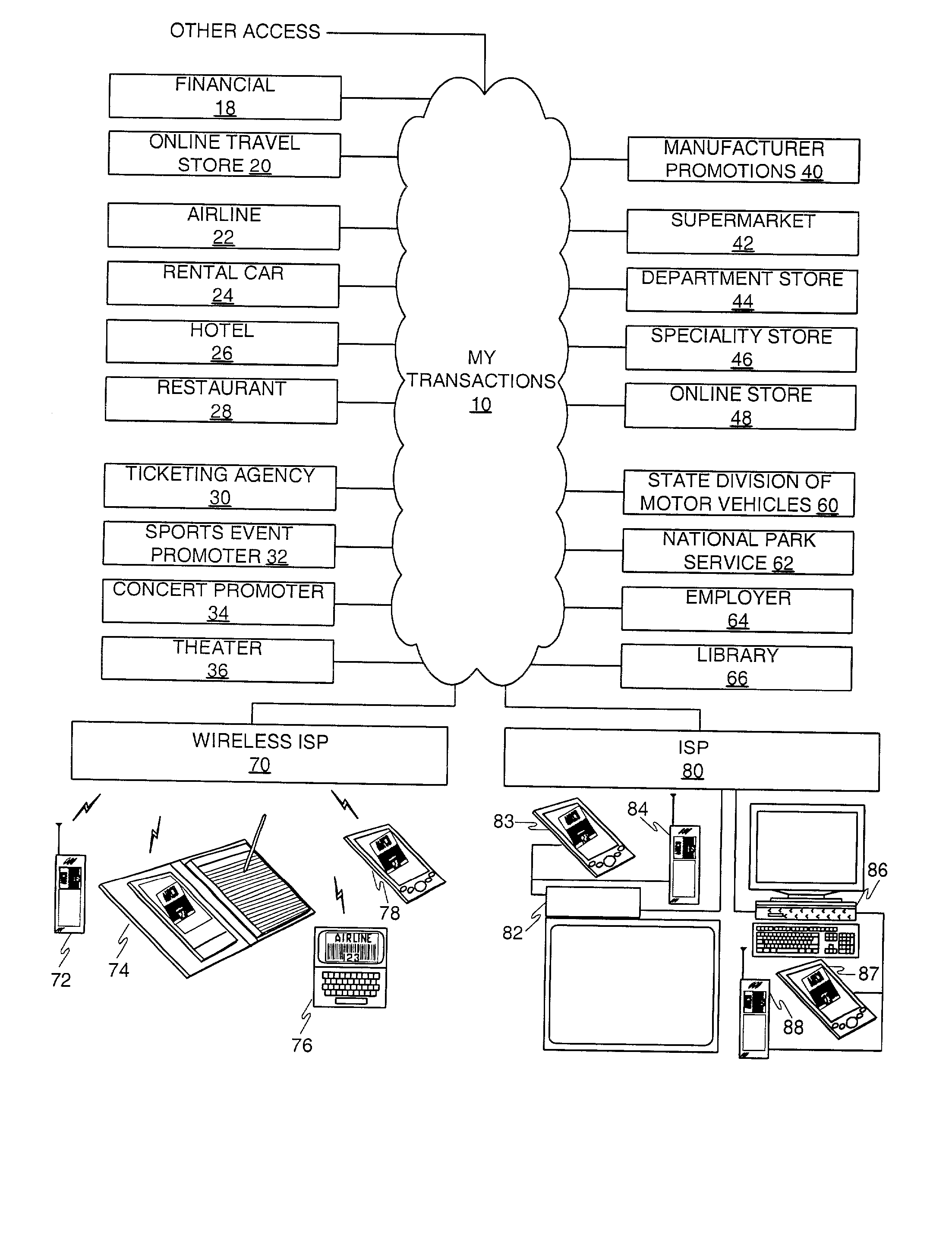

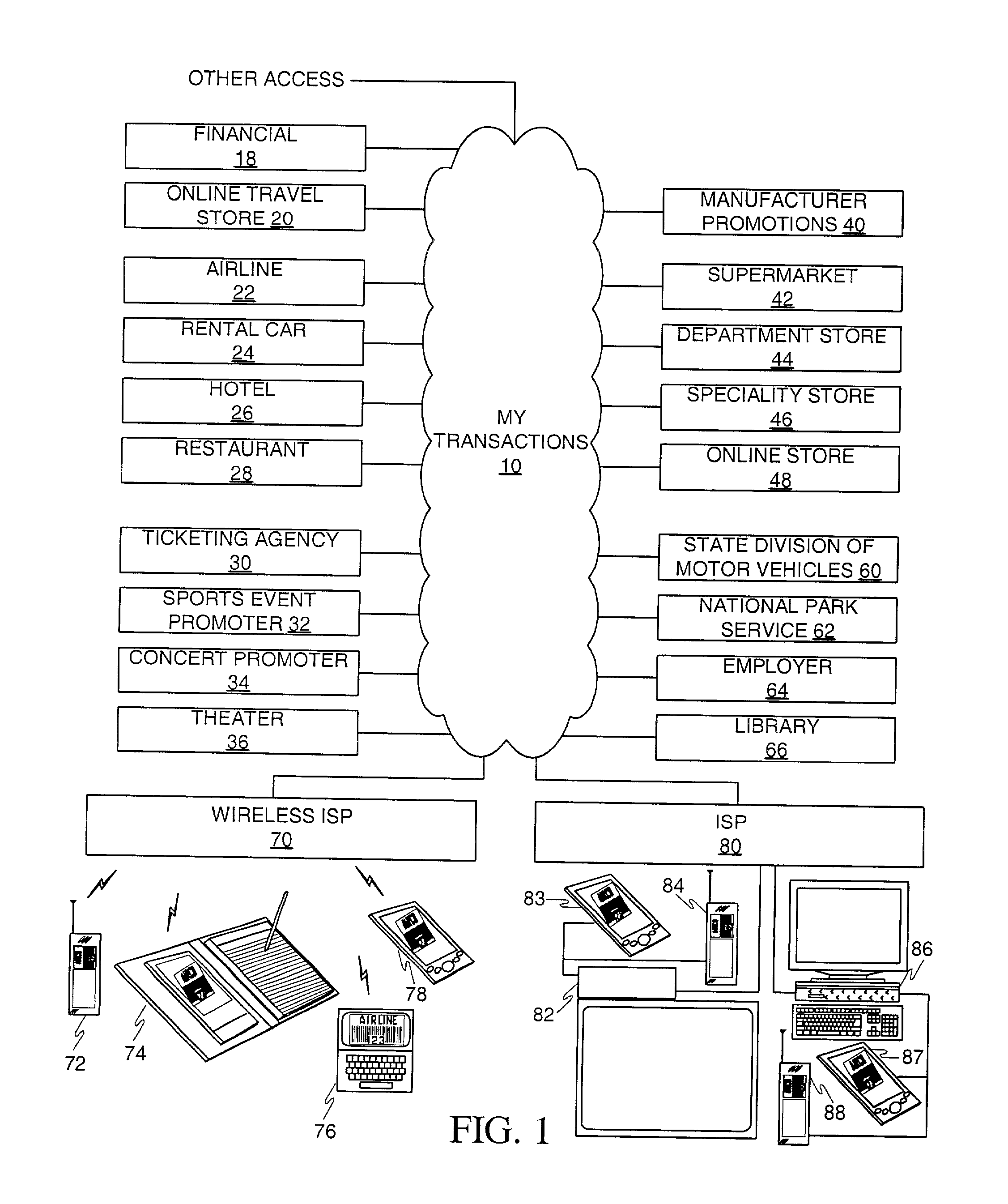

A user is provided with a secure database containing information in diverse categories that relates to the user and that may be represented at least in part in bar code form and communicated with light from a mobile communications device. The diverse information is obtained from any combination of a variety of vendor and governmental computer systems, internet service providers, and communications devices. The user has access to the database using a mobile communications device for displaying, managing, and entering information, and for communicating information in bar code form with light. The user first selects the category that contains the specific item of information, and then selects the specific item of information. The specific item of information then is communicated in bar code form with light from the mobile communications device for scanning by a bar code scanner to obtain the desired good or service.

Owner:SAMSUNG ELECTRONICS CO LTD

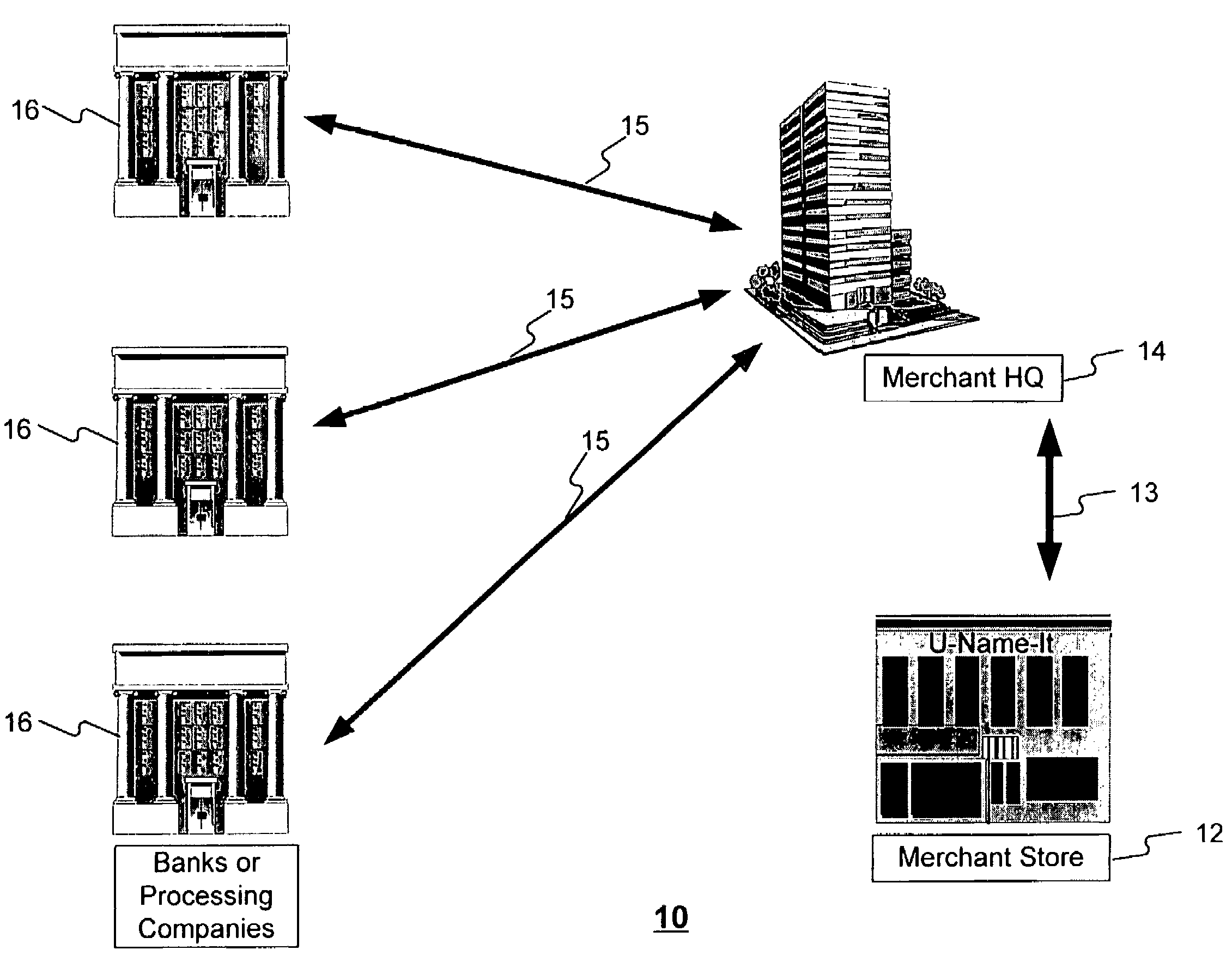

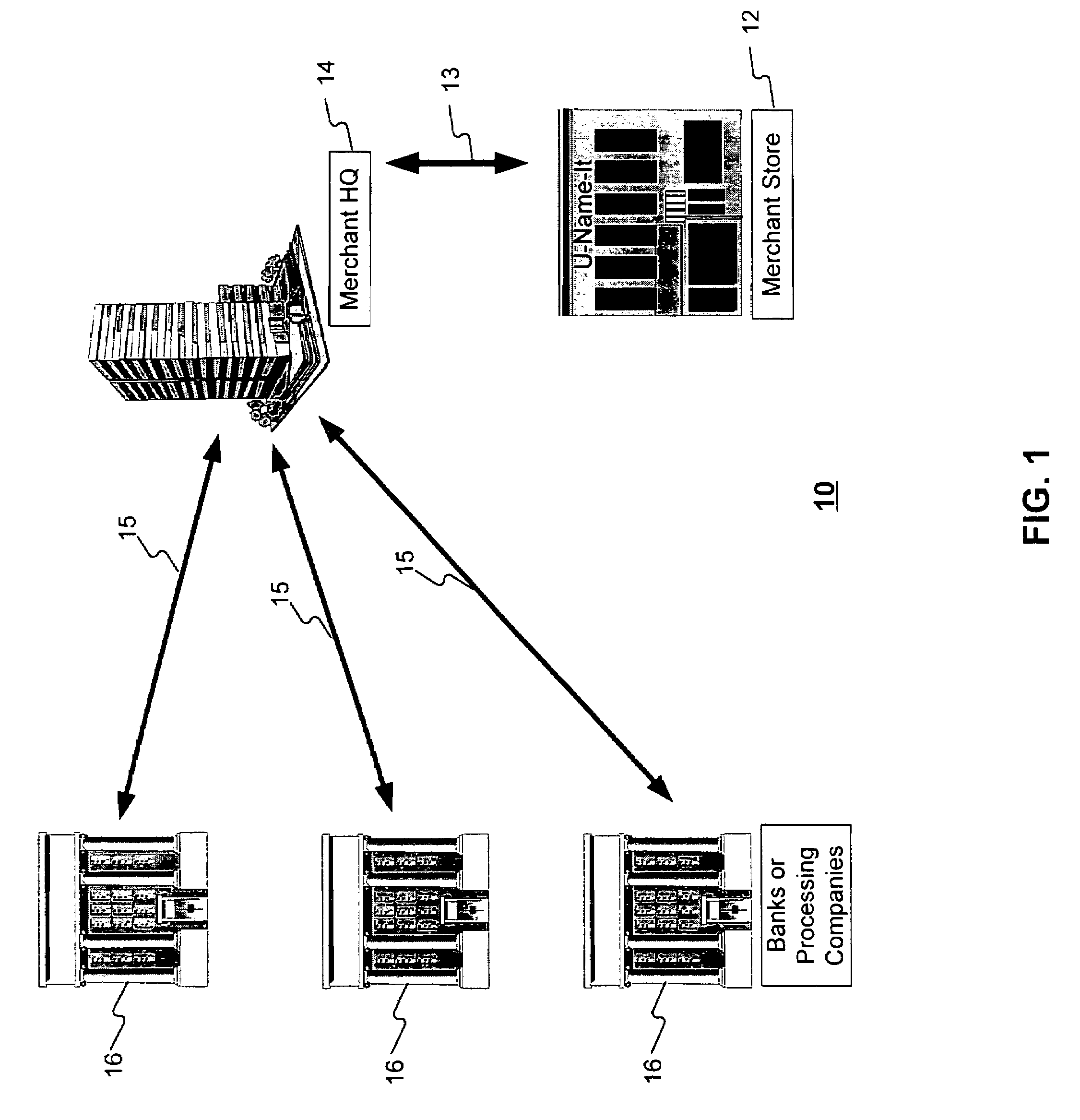

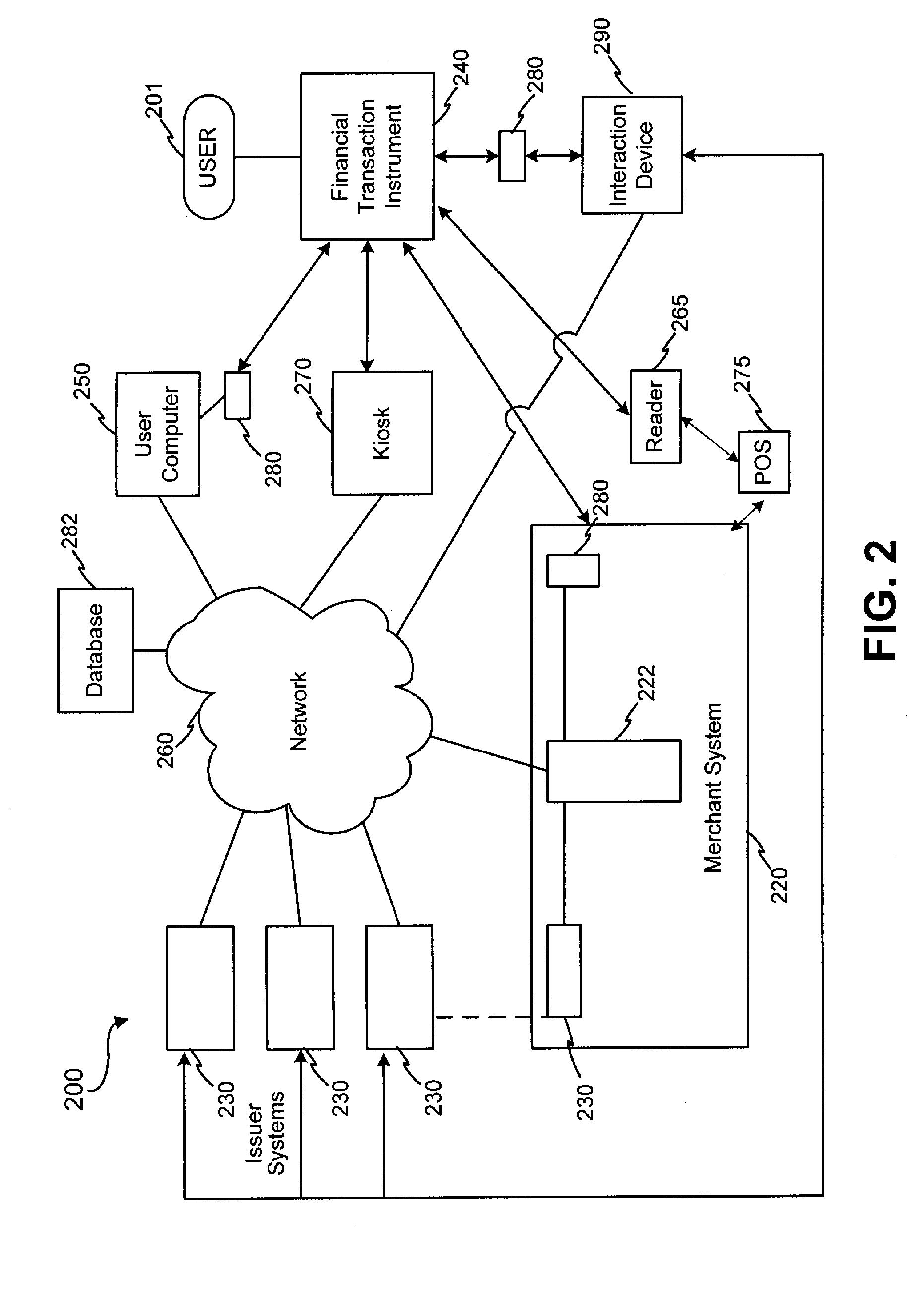

System and method for processing financial transactions

InactiveUS7571139B1Improve securityGreat degree of convenienceFinanceCash registersPaymentFinancial transaction

A network for processing retail sales transactions includes a customer transceiver with a unique customer number, a reader receiving the customer number and sending it to a point-of-sale device where it is combined with transaction information to form a transaction entry. The transaction entry is sent through a merchant computer to a transaction processing system having a customer database. The transaction processing system references an entry in the customer database corresponding to the customer / transmitter ID number and routes the transaction entry to a payment processing system specified in the customer database entry.

Owner:EXXON RES & ENG CO +1

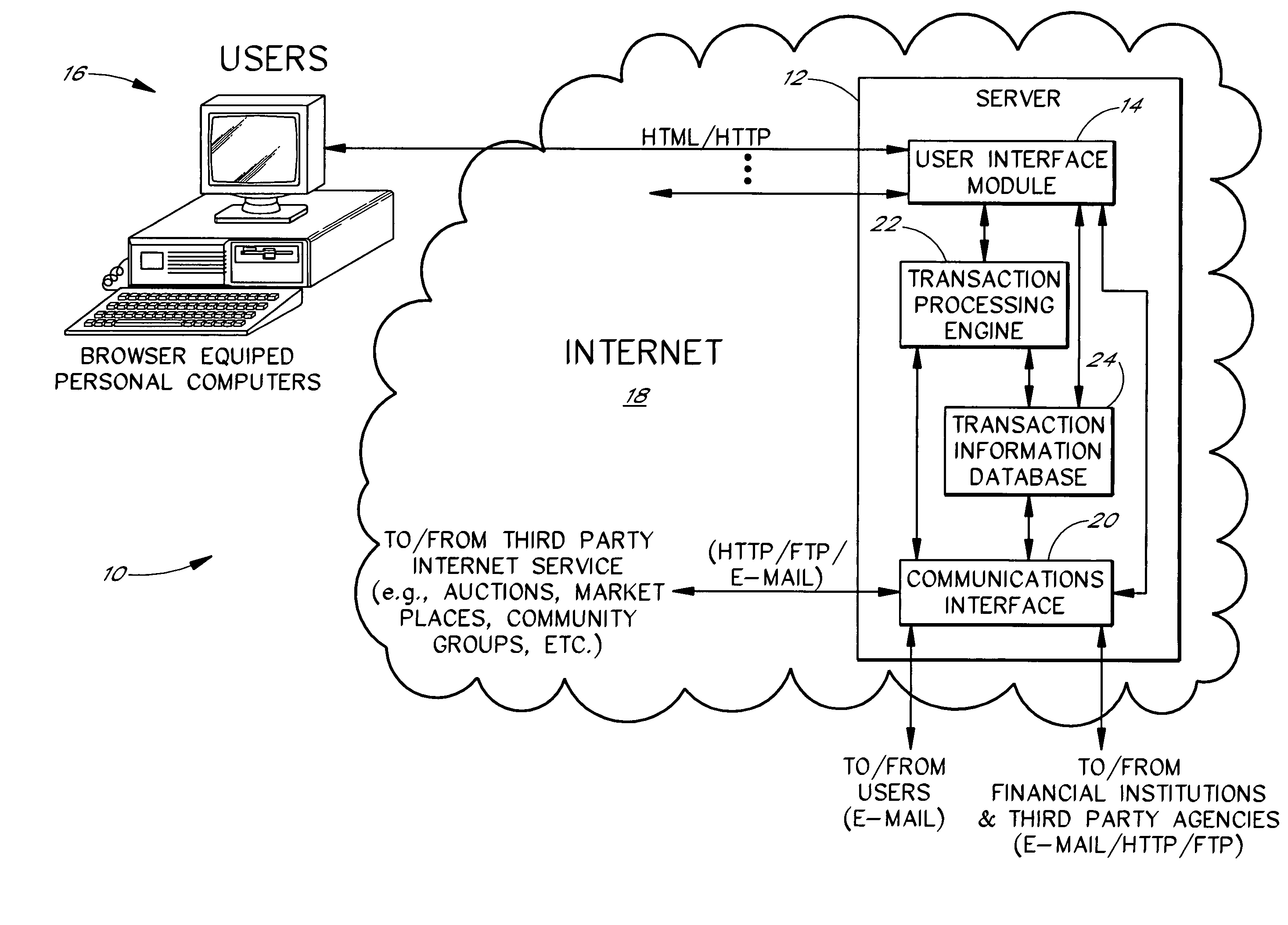

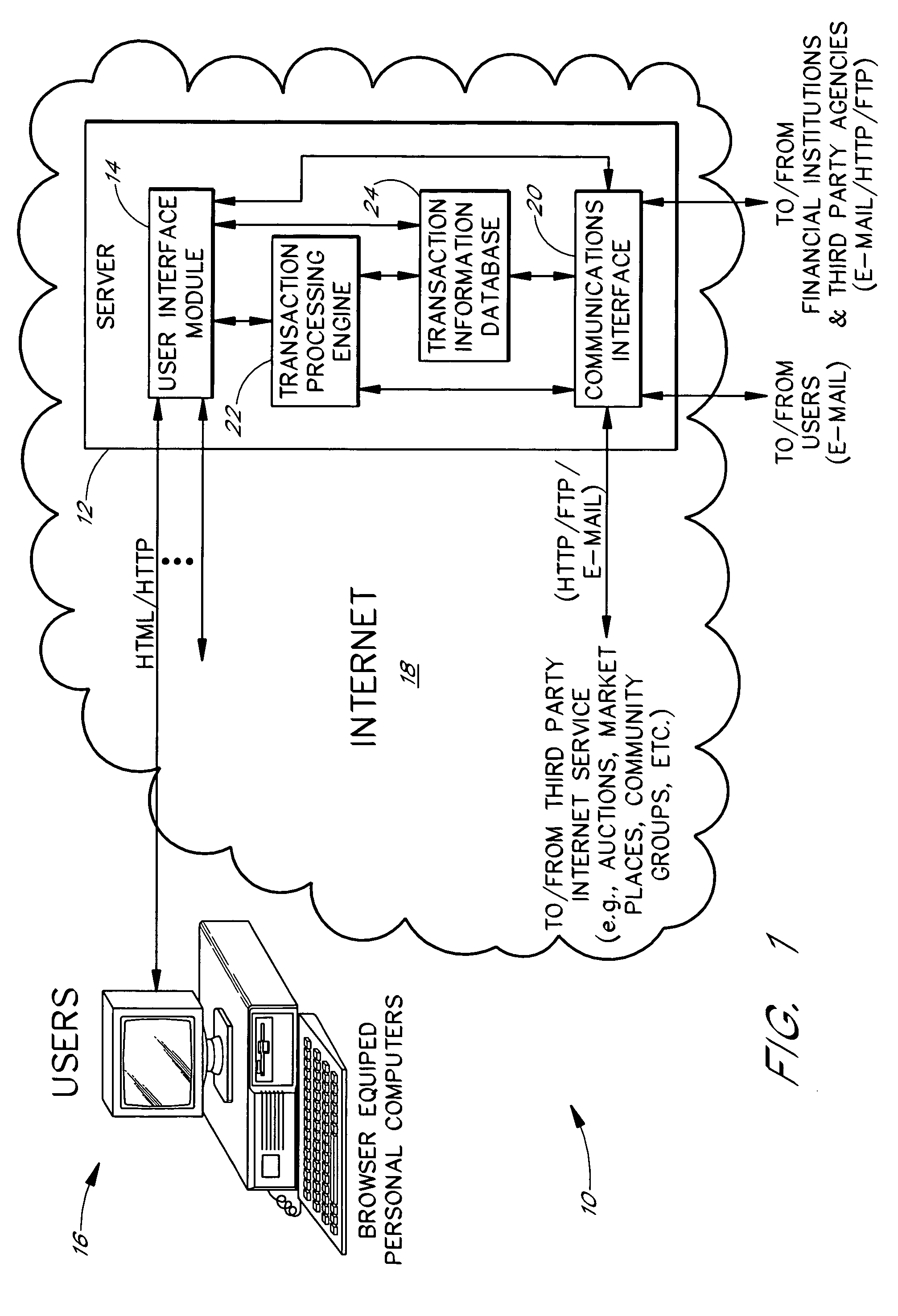

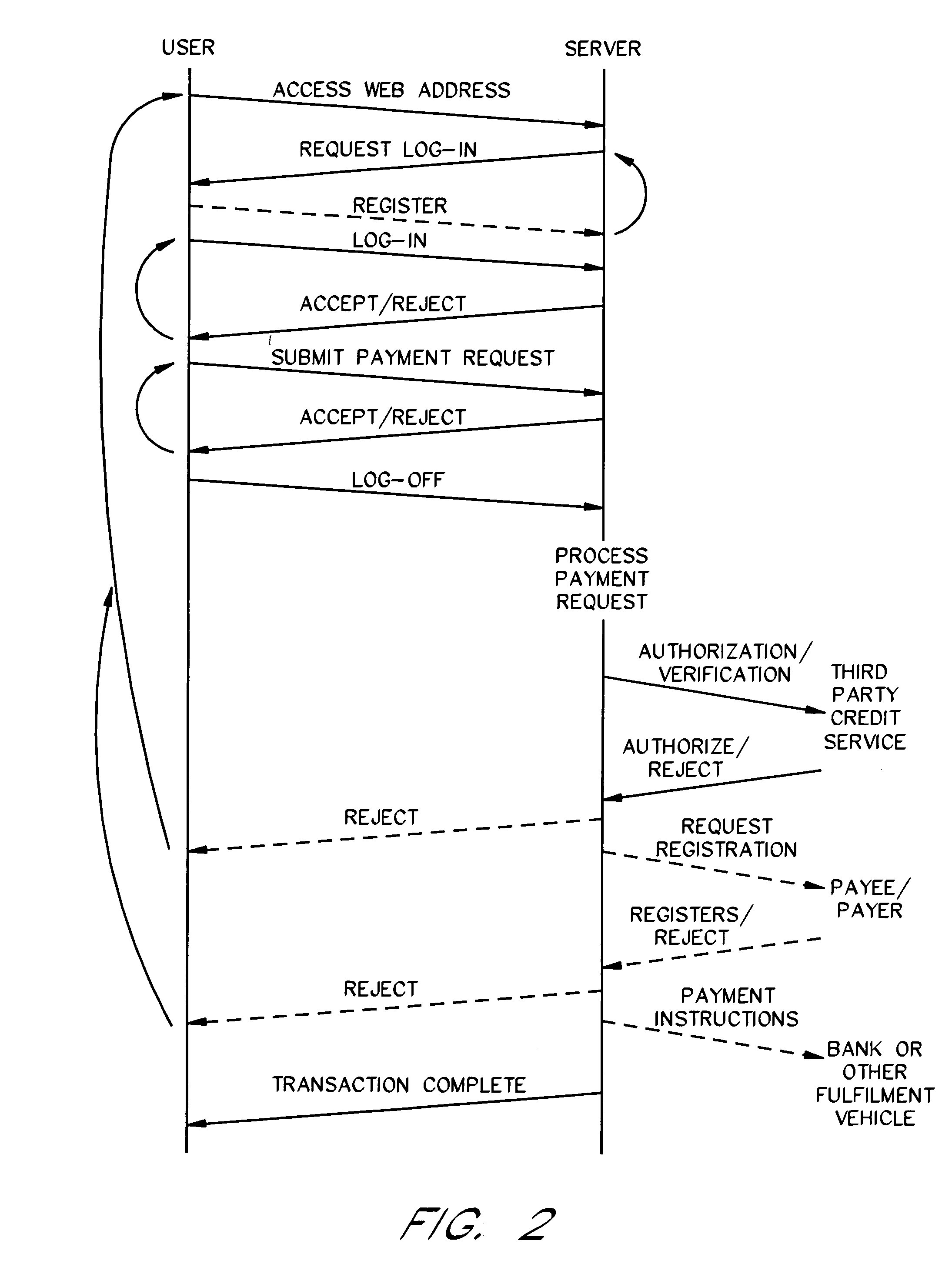

Computer-based funds transfer system

A service configured to be accessible by two or more parties to a two-sided funds transfer transaction through a computer network (e.g., the Internet) provides functionality for sending a payment request to a target payer or payee who is not yet registered with the service. Depending upon who is initiating the transaction (i.e., a payer or a payee) the payment requests may be received as requests to send payments or requests to collect payments. In the latter case, the service may be further organized to solicit a payment, for example by transmitting an e-mail message to a second party to the funds transfer transaction. When used to collect payments, the service may be further organized to process one or more responses to the above-mentioned solicitations.

Owner:ACCENT COM INC +1

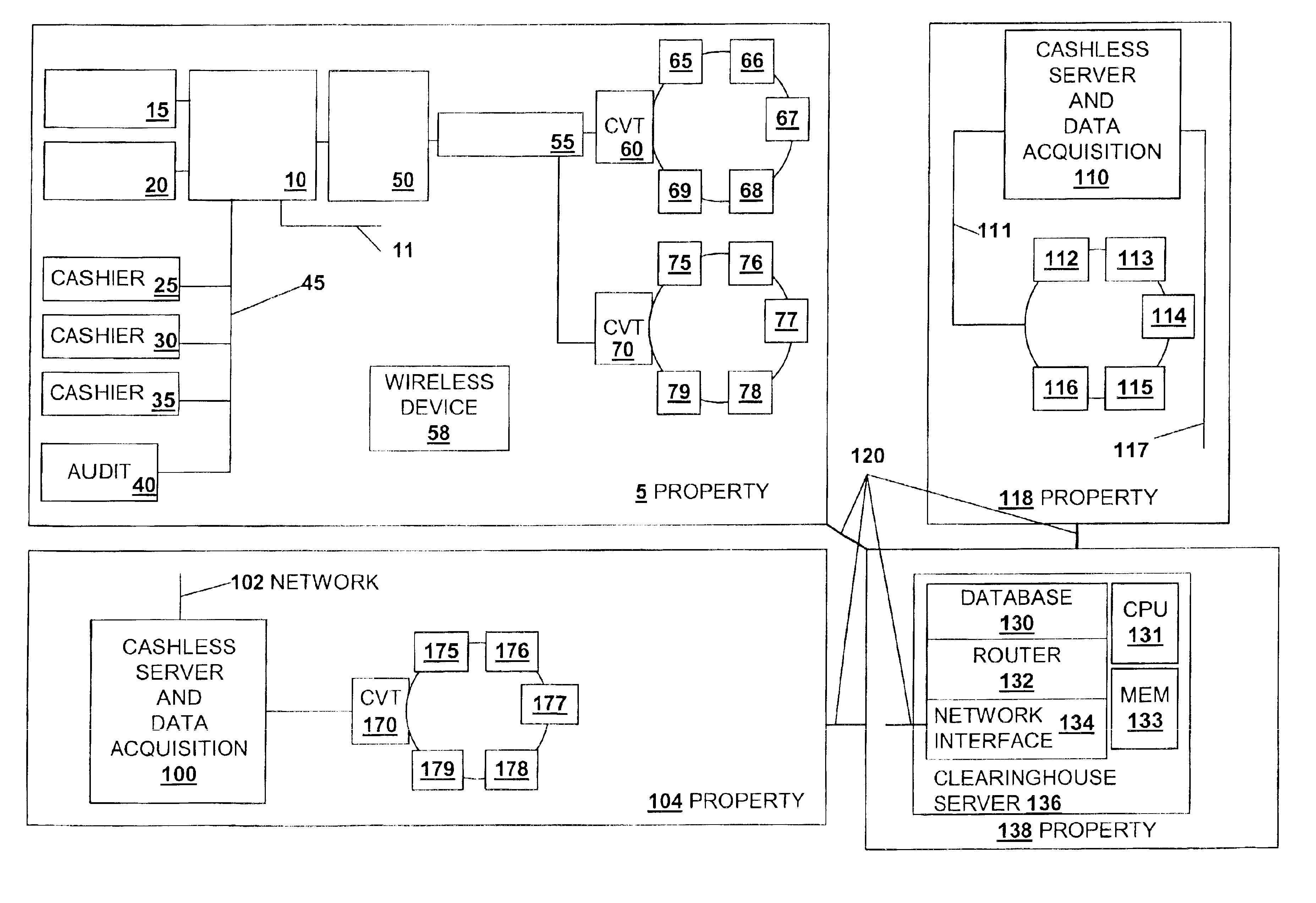

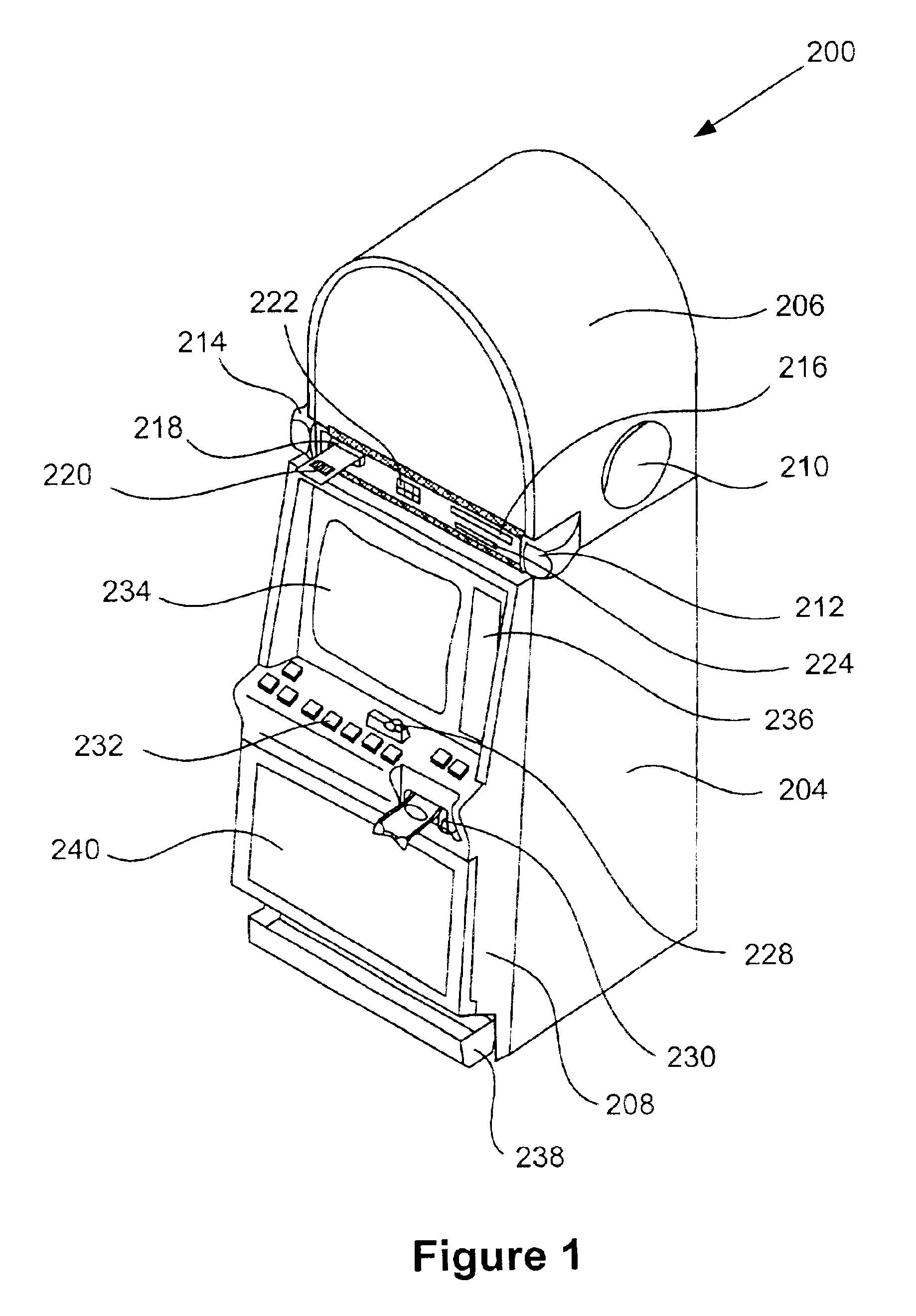

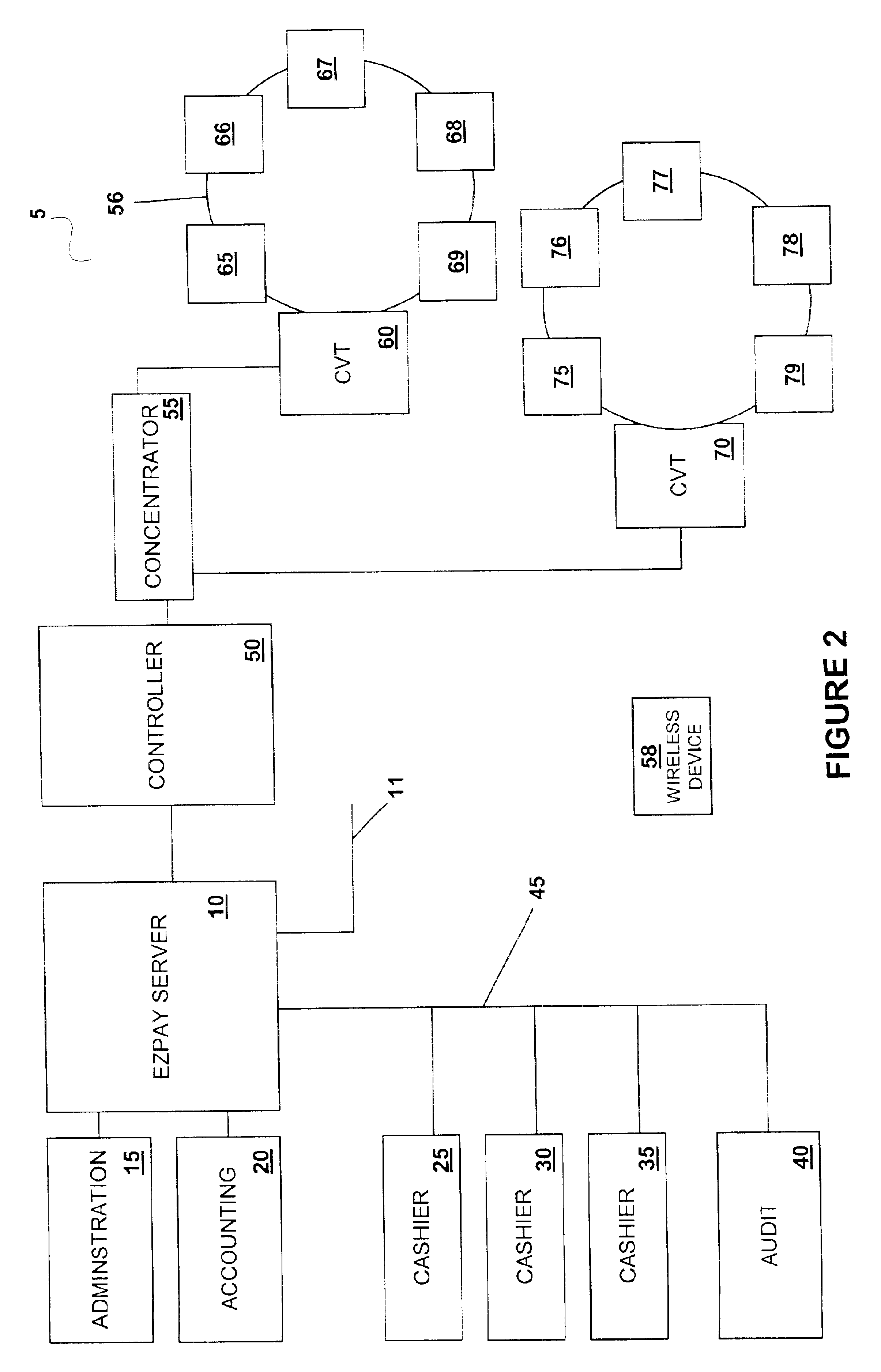

Cashless transaction clearinghouse

InactiveUS6866586B2Reduce the possibilityApparatus for meter-controlled dispensingPre-payment schemesEngineeringFinancial transaction

A disclosed cashless instrument transaction clearinghouse provides clearinghouse server including a network interface allowing the cashless instrument transaction clearinghouse to communicate with a number of gaming properties and a processor configured to enable the validation of cashless instruments at a gaming property different from where the cashless instrument was generated. Methods are provided that allow a plurality of cashless gaming devices located at different gaming properties to communicate with one another via the cashless instrument transaction clearinghouse in a secure manner using symmetric and asymmetric encryption techniques. Further, to reduce the possibilities of theft and fraud, the methods allow a receiver of a message to authenticate an identity of a sender of a message.

Owner:IGT

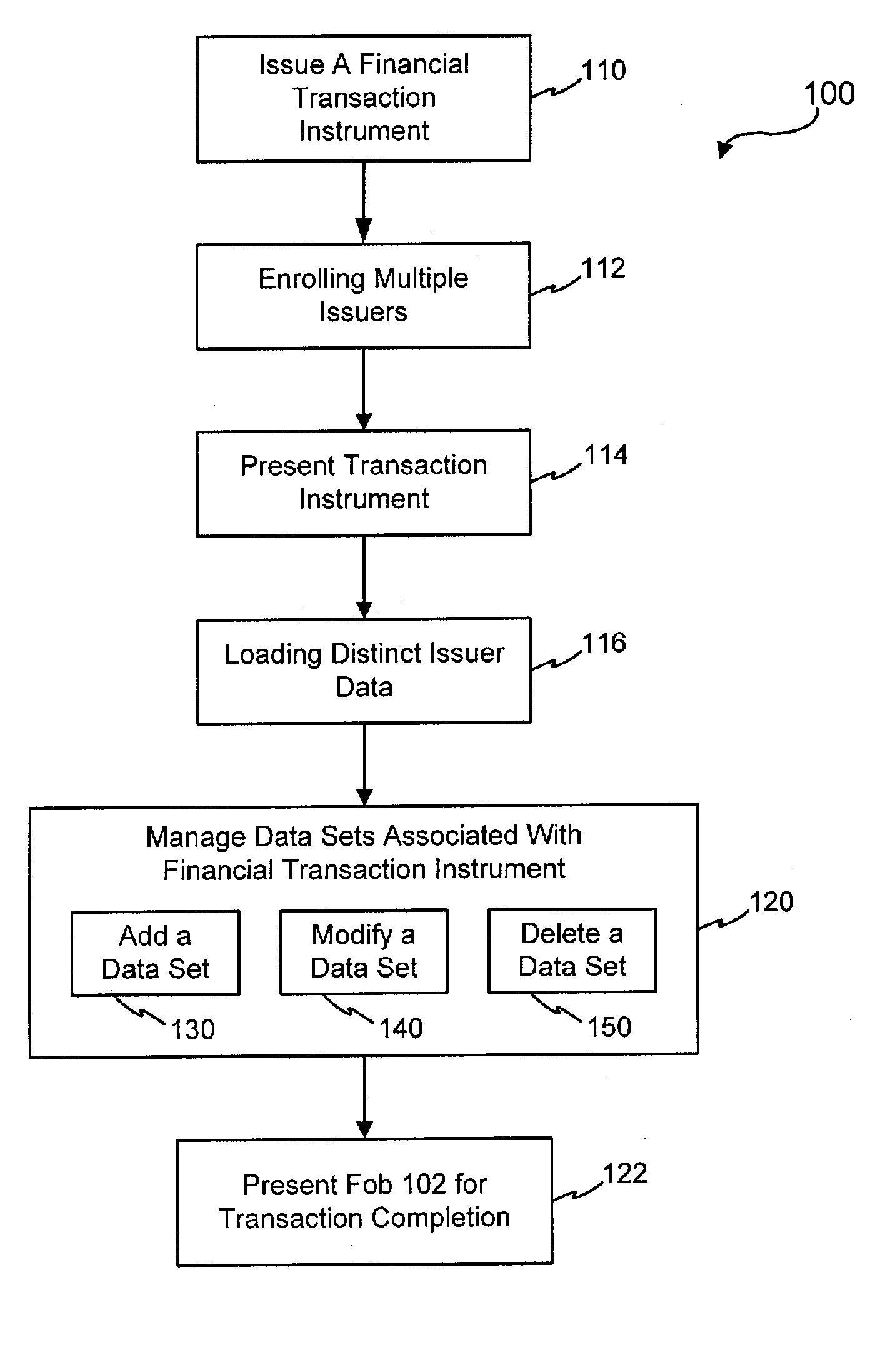

Systems and methods for managing multiple accounts on a RF transaction device using secondary identification indicia

InactiveUS20050171898A1Easy to manageEliminate needAcutation objectsFinanceData setFinancial transaction

Systems and methods are configured to manage data sets associated with a transaction device. For example, a method is provided for facilitating the management of distinct data sets on a transaction device that are provided by distinct data set owners, wherein the distinct data sets may include differing formats. The method includes the steps of: adding, by a read / write, a first data set to the financial transaction device, wherein the first data set is owned by a first owner; adding, by the read / write device, a second data set to the financial transaction device, wherein the second data set is owned by a second owner; and storing the first data set and the second data set on the financial transaction device in accordance with an owner defined format. The first and second data sets are associated with first and second owners, respectively, and are configured to be stored independent of each other The transaction device user may be permitted to select at least one of the multiple data sets for transaction completion using a secondary identifier indicia. Where the user selects multiple accounts for transaction completion, the user may be permitted to allocate portions of a transaction to the selected transaction accounts. The transaction request may be processed in accordance with the user's allocations.

Owner:LIBERTY PEAK VENTURES LLC

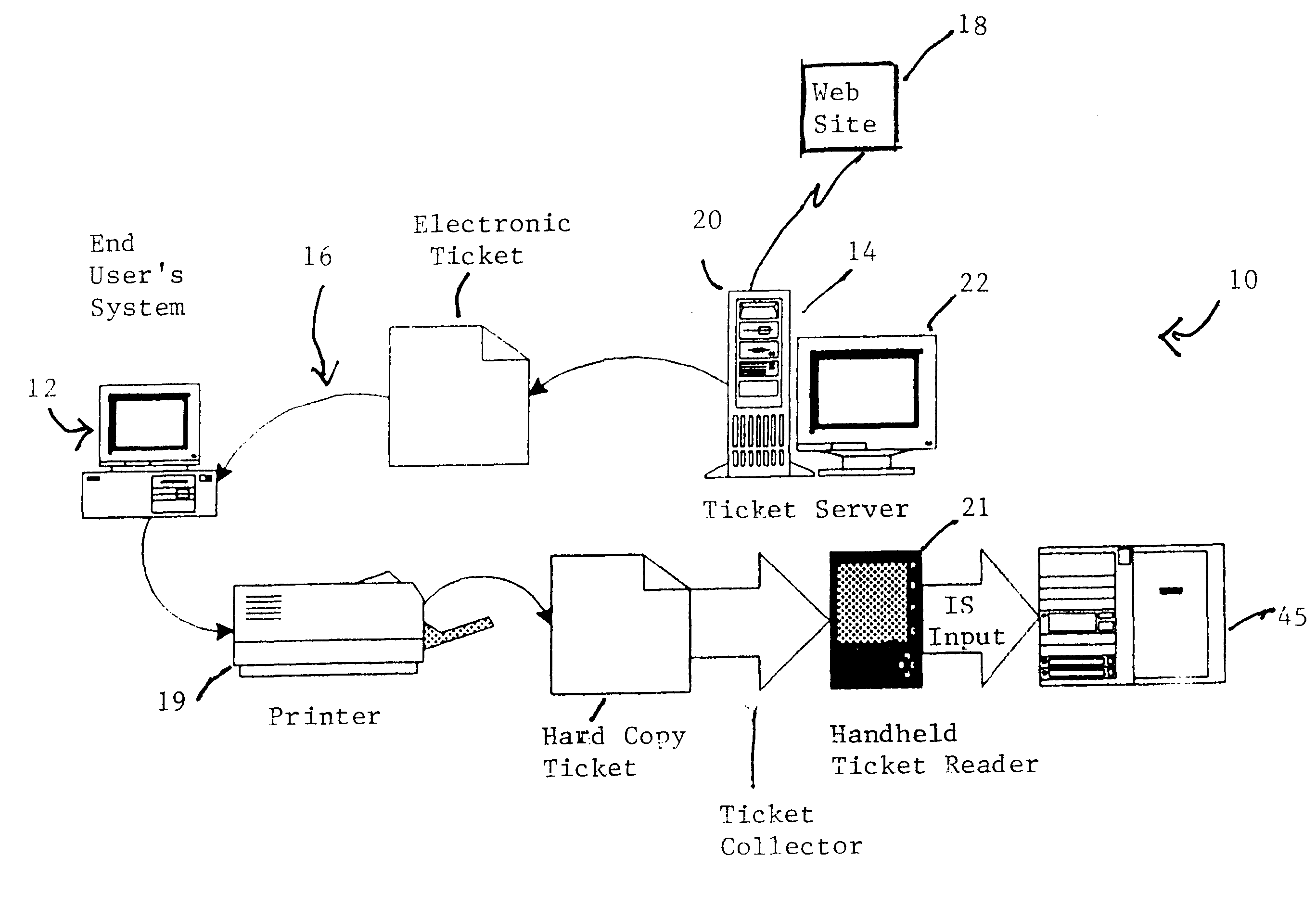

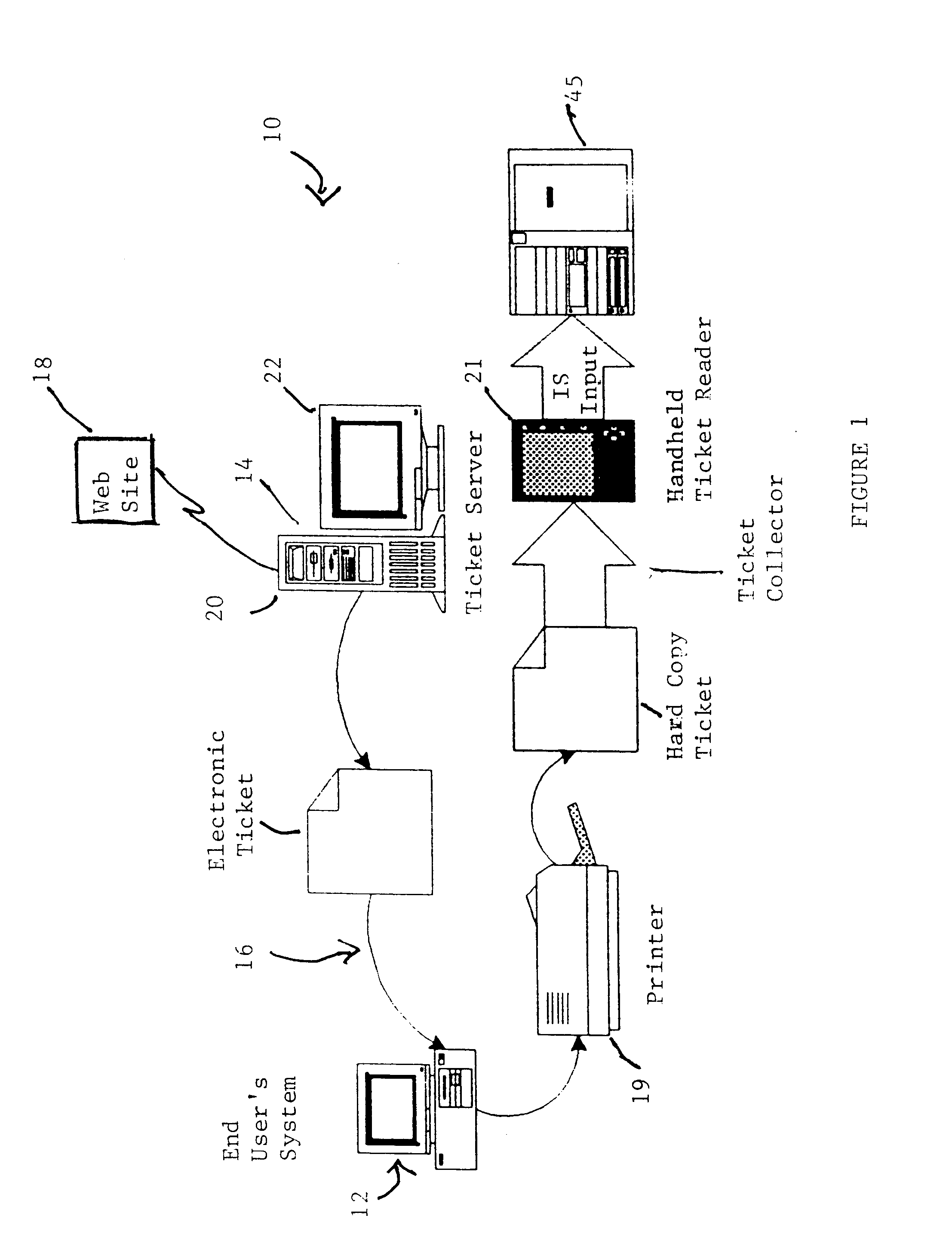

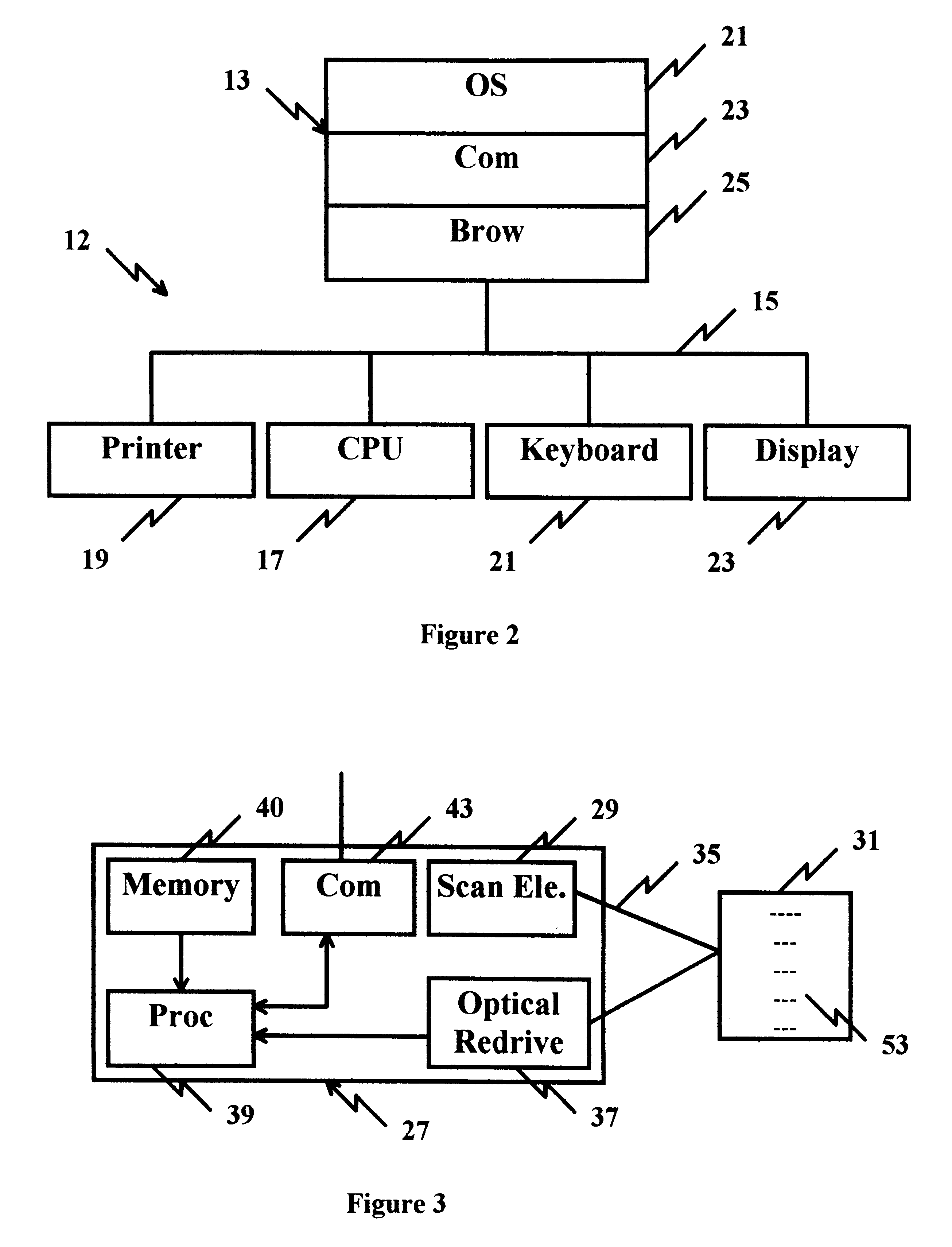

Cryptographic encoded ticket issuing and collection system for remote purchasers

InactiveUS6223166B1Prevent ticket fraudTicket-issuing apparatusElectrical apparatusCollection systemInformation networks

A cryptographic encoded, ticket issuing and collection system for real-time purchase of tickets by purchasers at remote user stations in an information network that includes a plurality of remote user stations coupled to a server in an information network, e.g., the Internet, for purchase of services, products, or tickets to an event. An operator of the remote user station selects a ticket for purchase to an event using standard protocols of information network. An electronic ticket is transmitted to the operator and includes a cypher code created using a public key cryptography system. The operator displays the electronic ticket for verification purposes and proceeds to print out the ticket at the station. The ticket is presented to a ticket collector whereupon the ticket is scanned by a portable terminal for decoding the cypher code using a public key reloaded into the terminal by the producers of the event. The decoded cypher code is compared against the event description stored in the portable terminal and if equal, the ticket is accepted for admission to the event. The ticket information is stored in the portable terminal and subsequently uploaded to the information system to check for duplicate tickets.

Owner:IBM CORP

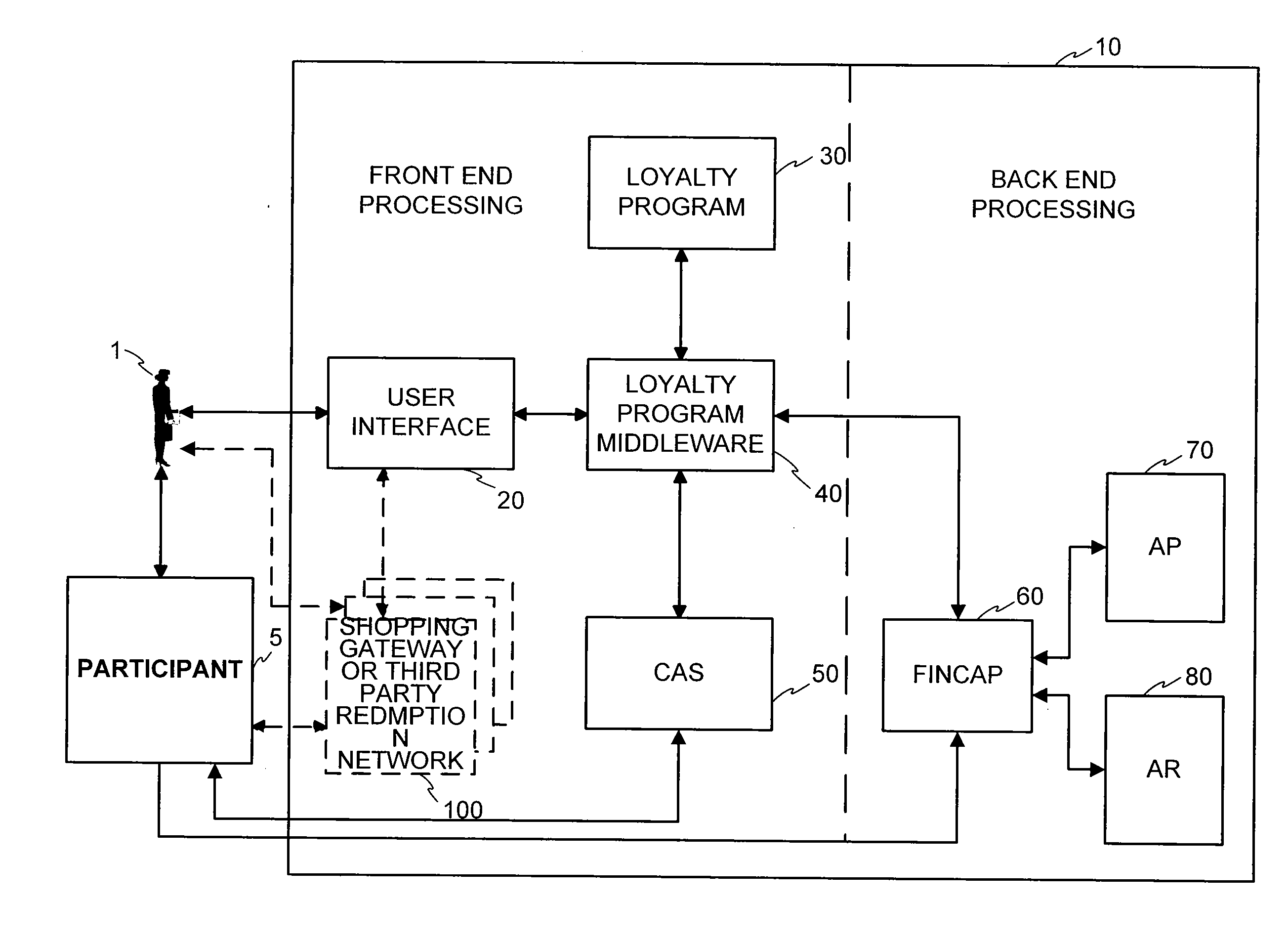

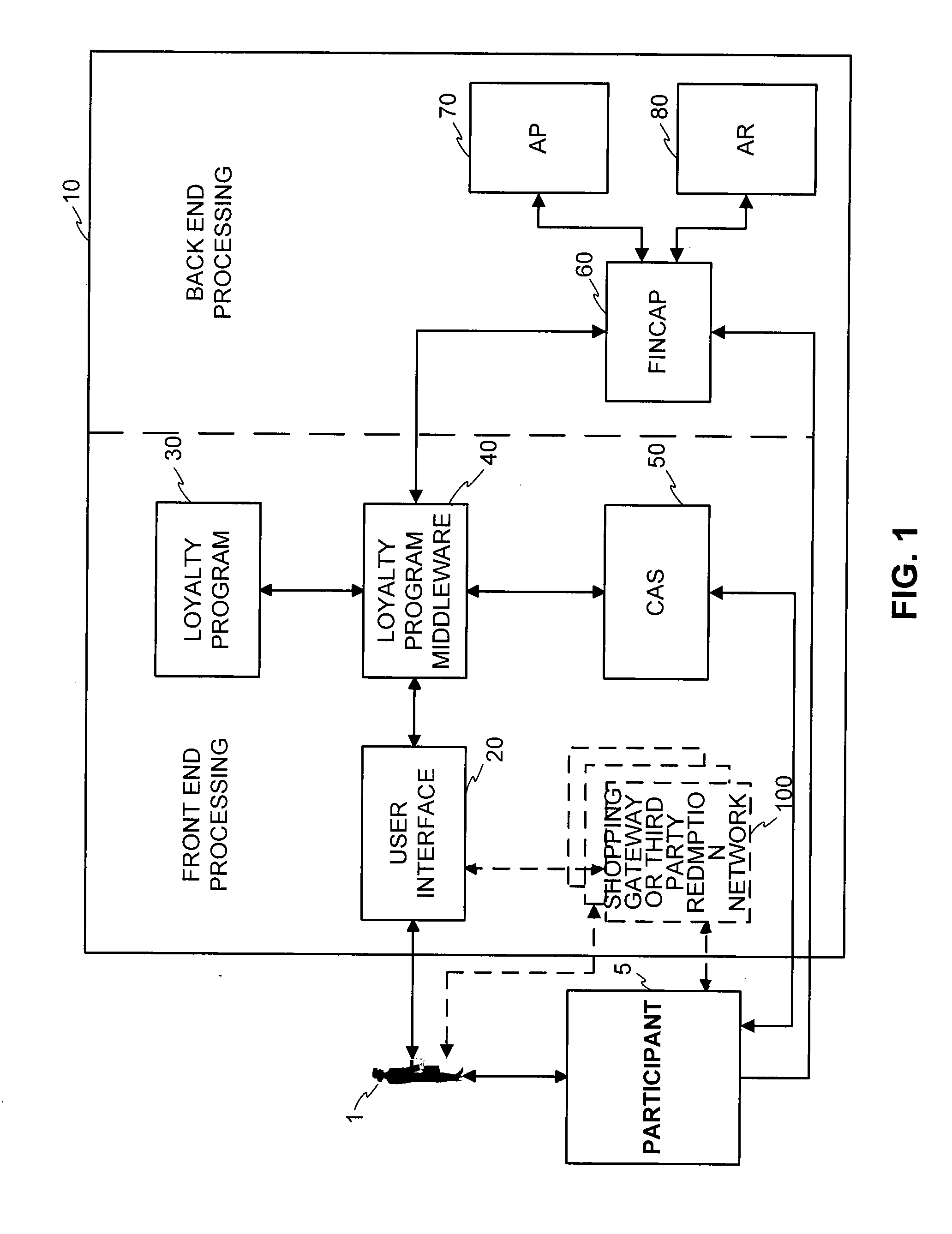

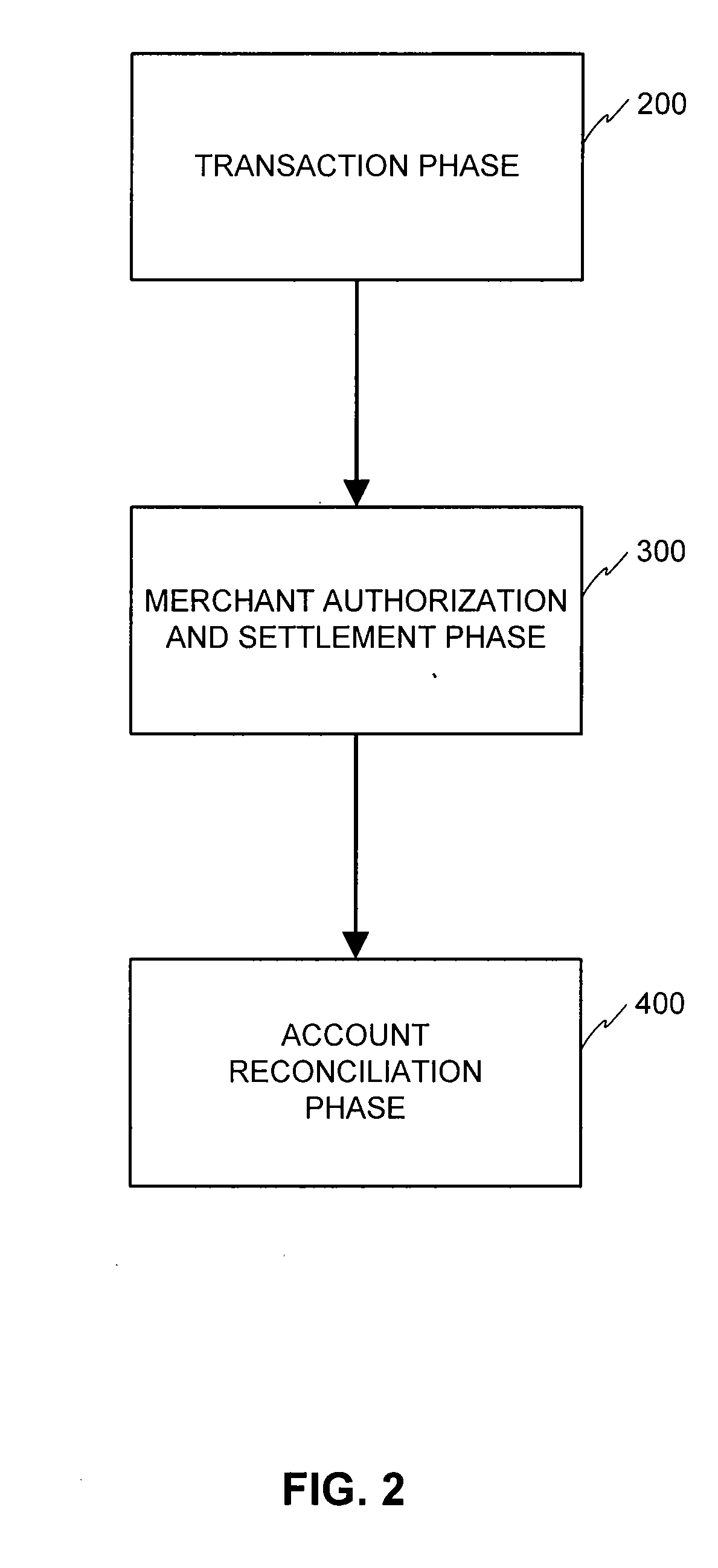

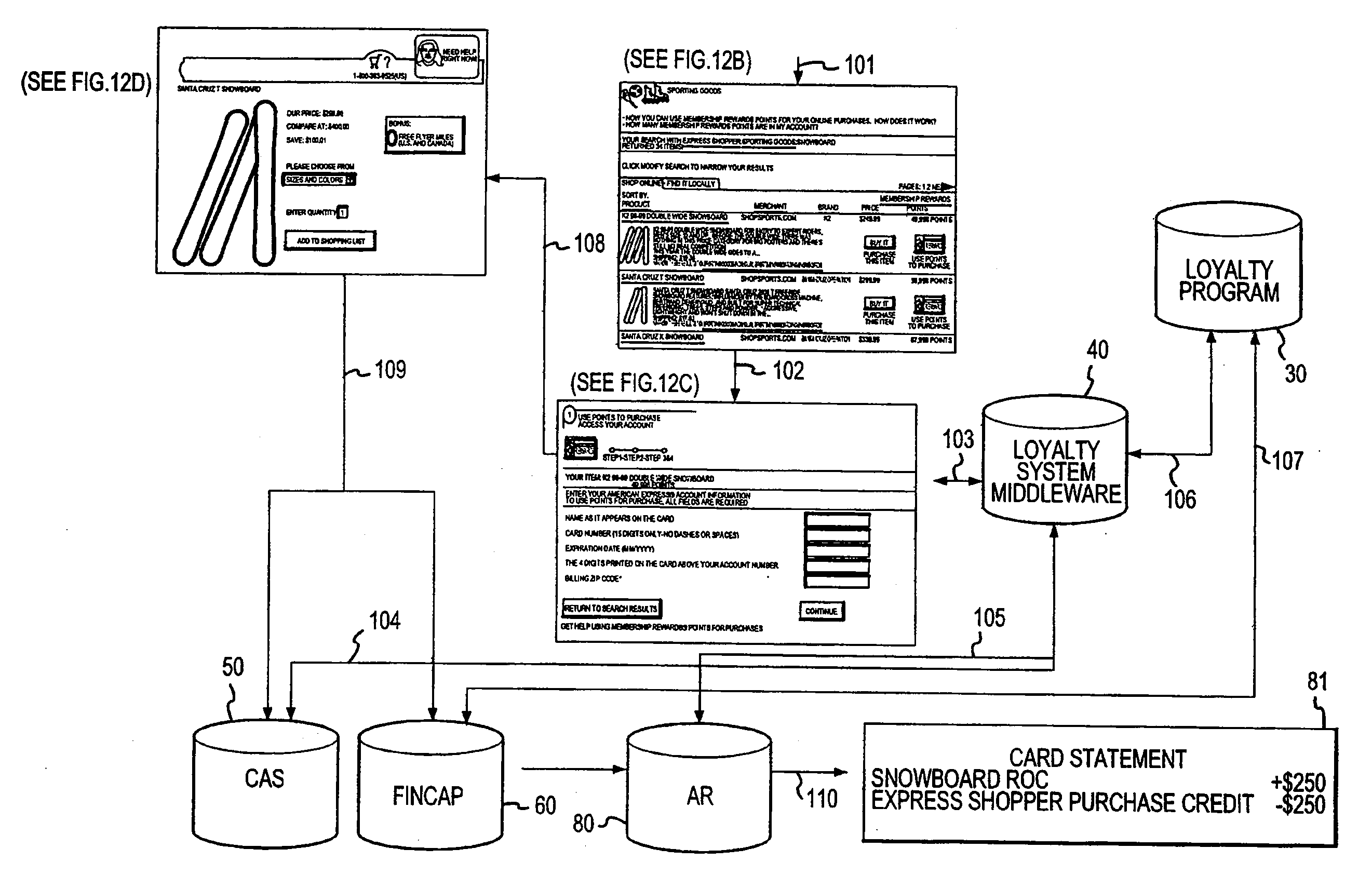

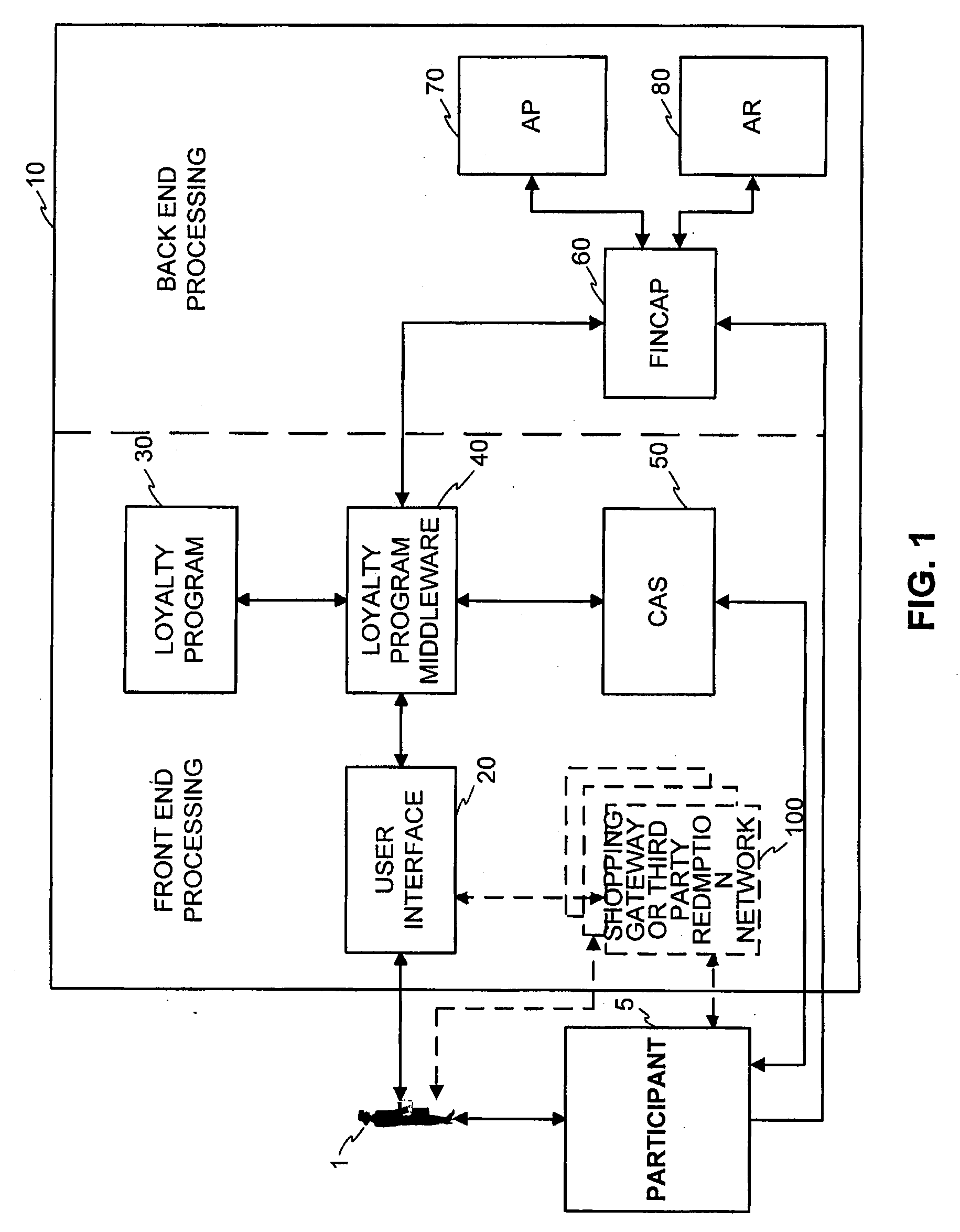

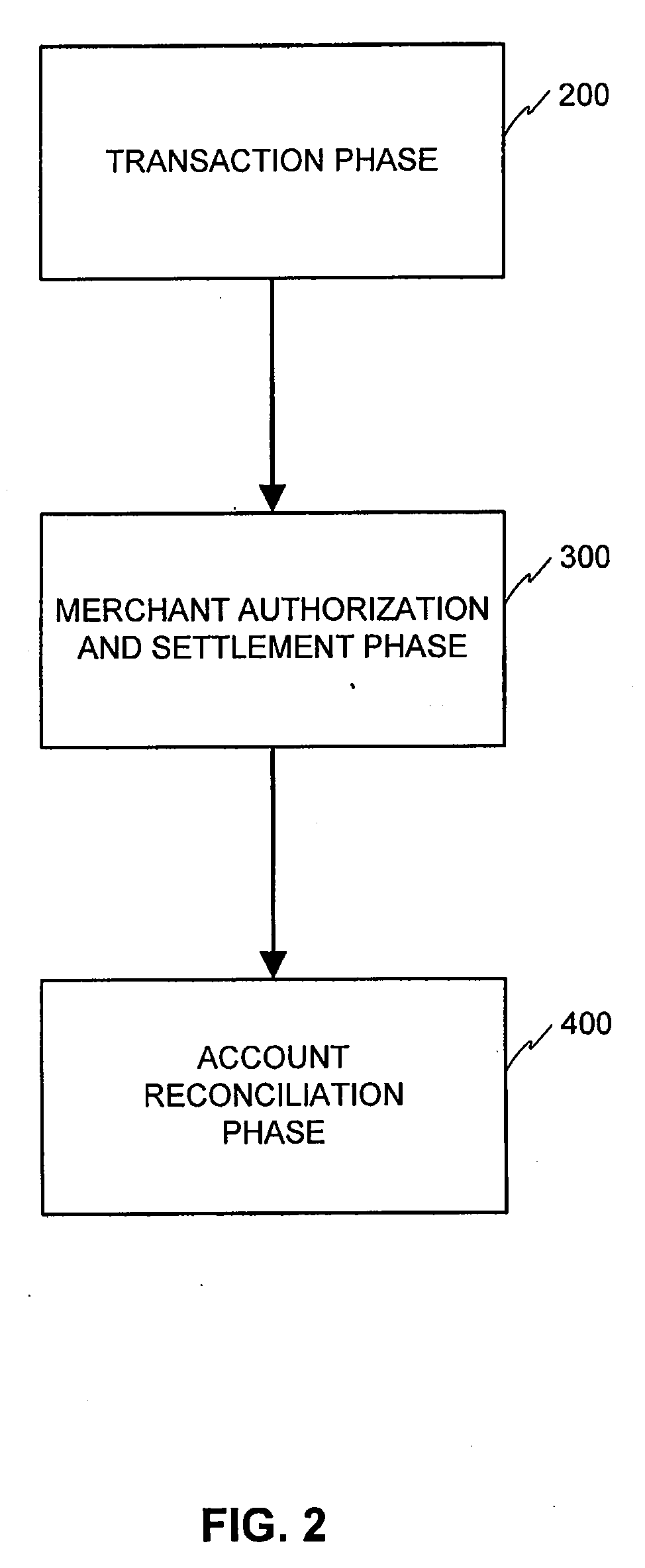

System and method for issuing and using a loyalty point advance

InactiveUS20070129955A1Convenient transactionFinanceBilling/invoicingLoyalty programComputer science

A system and method for spending loyalty points over a computerized network to facilitate a loyalty point transaction is disclosed. The system enables a participant of a loyalty program to accept an advance of loyalty point when a loyalty account balance is insufficient to make a desired purchase. An amount of loyalty points available as an advance to a participant is determined based on a number of criteria related to the participant, financial account activity, and loyalty account activity. The participant is allotted a predetermined length of time to earn or purchase enough loyalty points to repay the balance of advanced loyalty points. If, at the conclusion of such predetermined length of time, sufficient points have not been earned to offset the loyalty point advance, the participant is charged the currency value of each outstanding loyalty point. The participant may be assessed interest charges and / or fees at the time of the loyalty point advance, during reimbursement, or at the end of a time period for reimbursement.

Owner:AMERICAN EXPRESS TRAVEL RELATED SERVICES CO INC +1

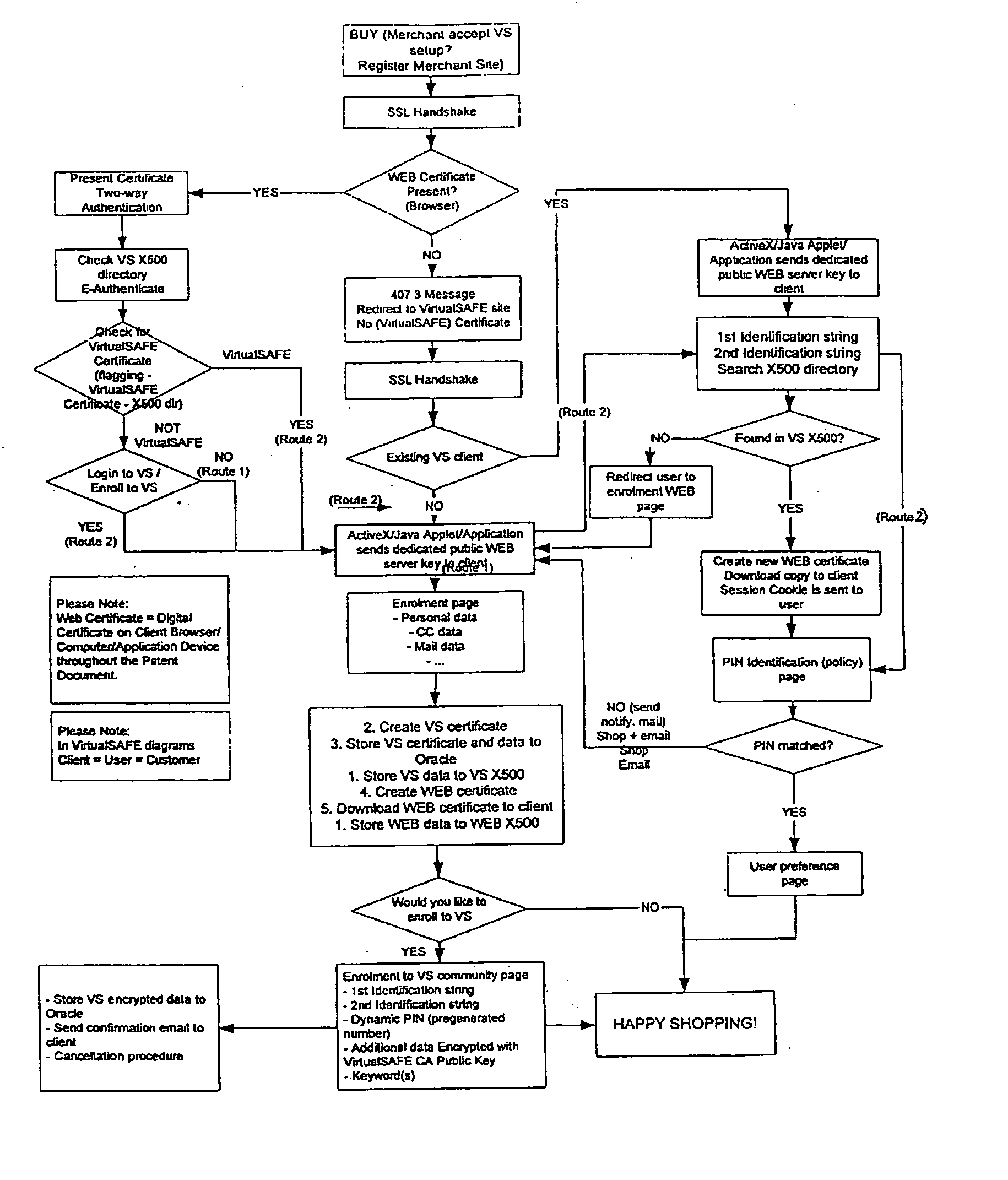

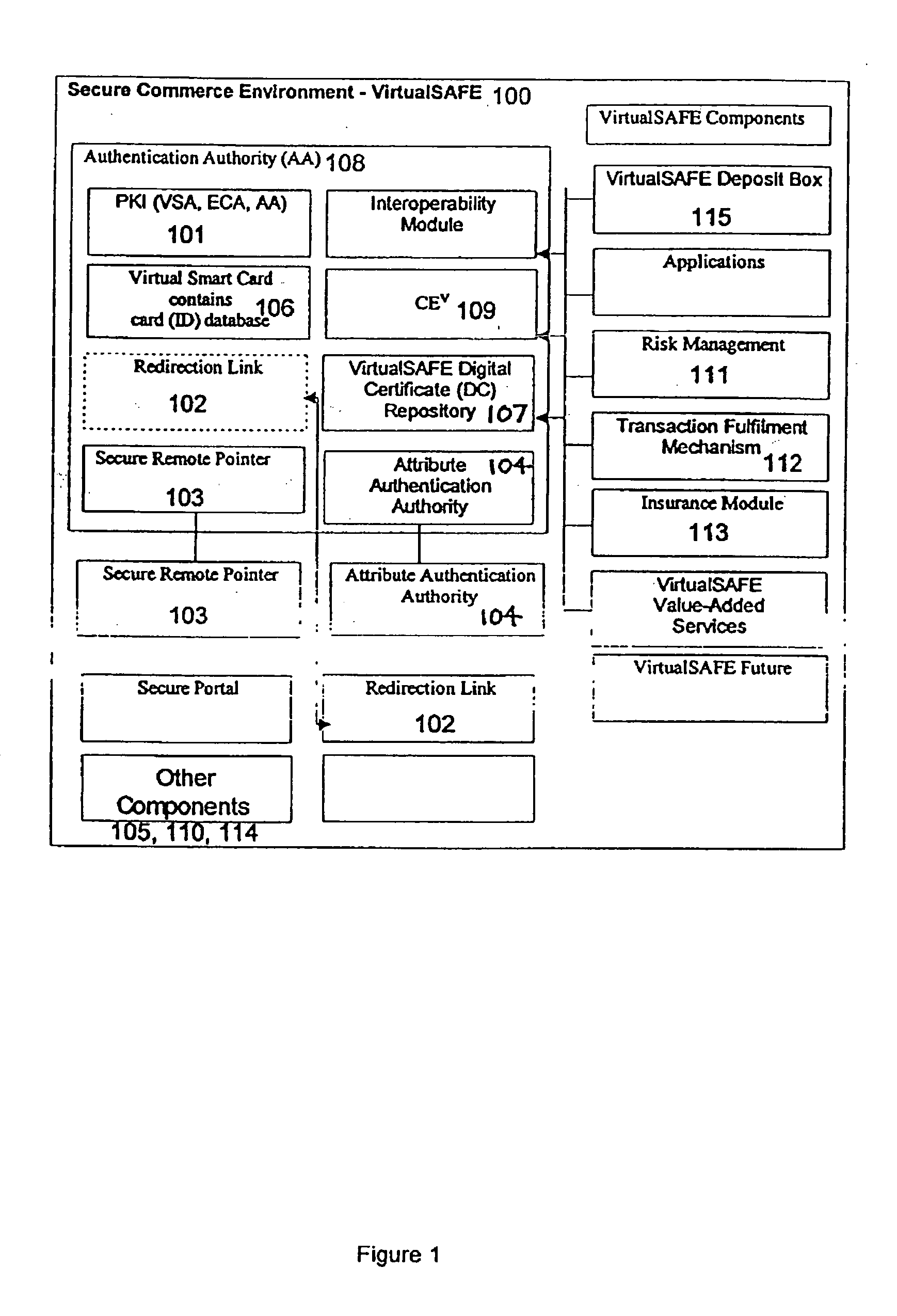

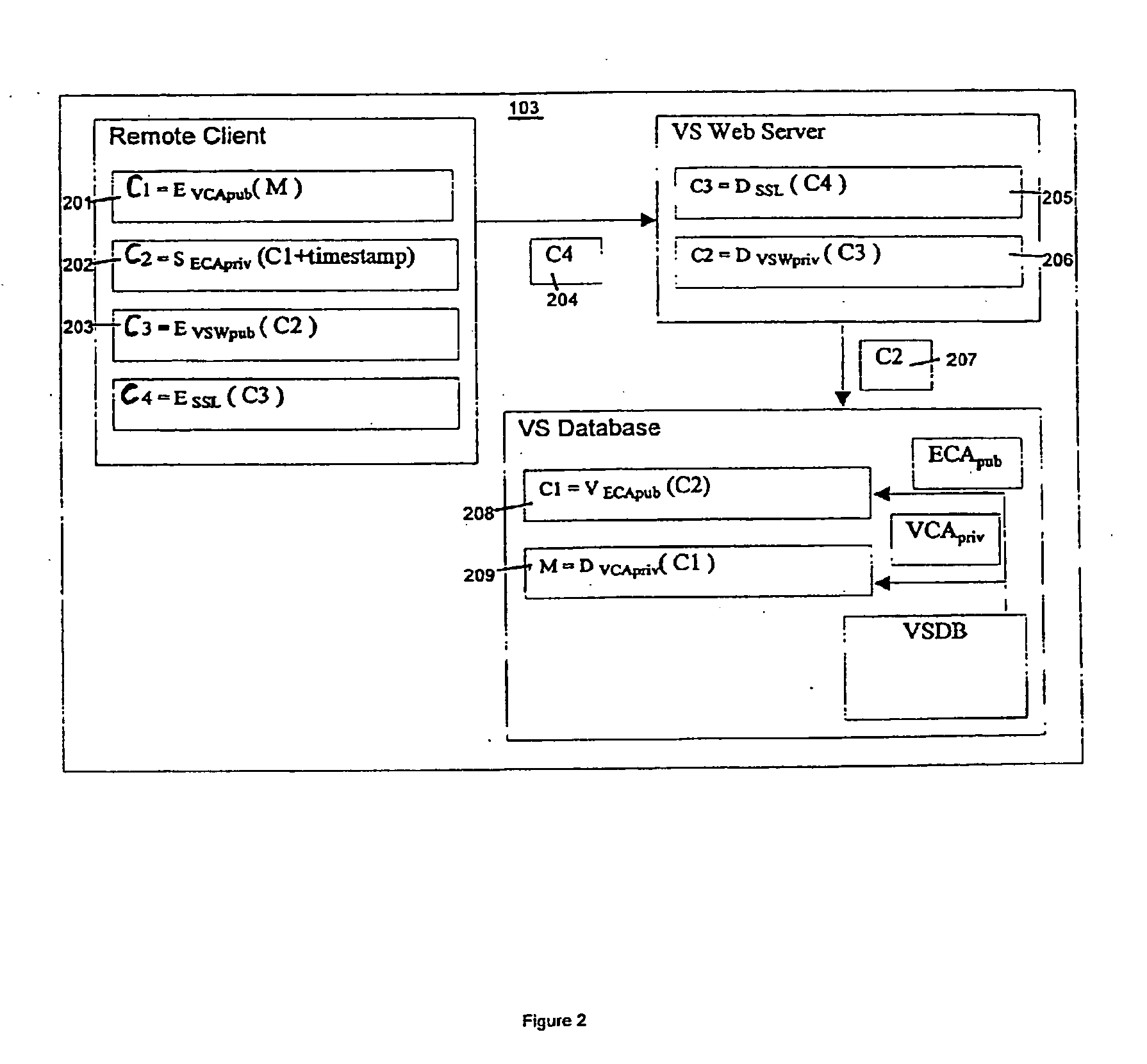

Method and system for a virtual safe

Owner:SARCANIN BRANKO

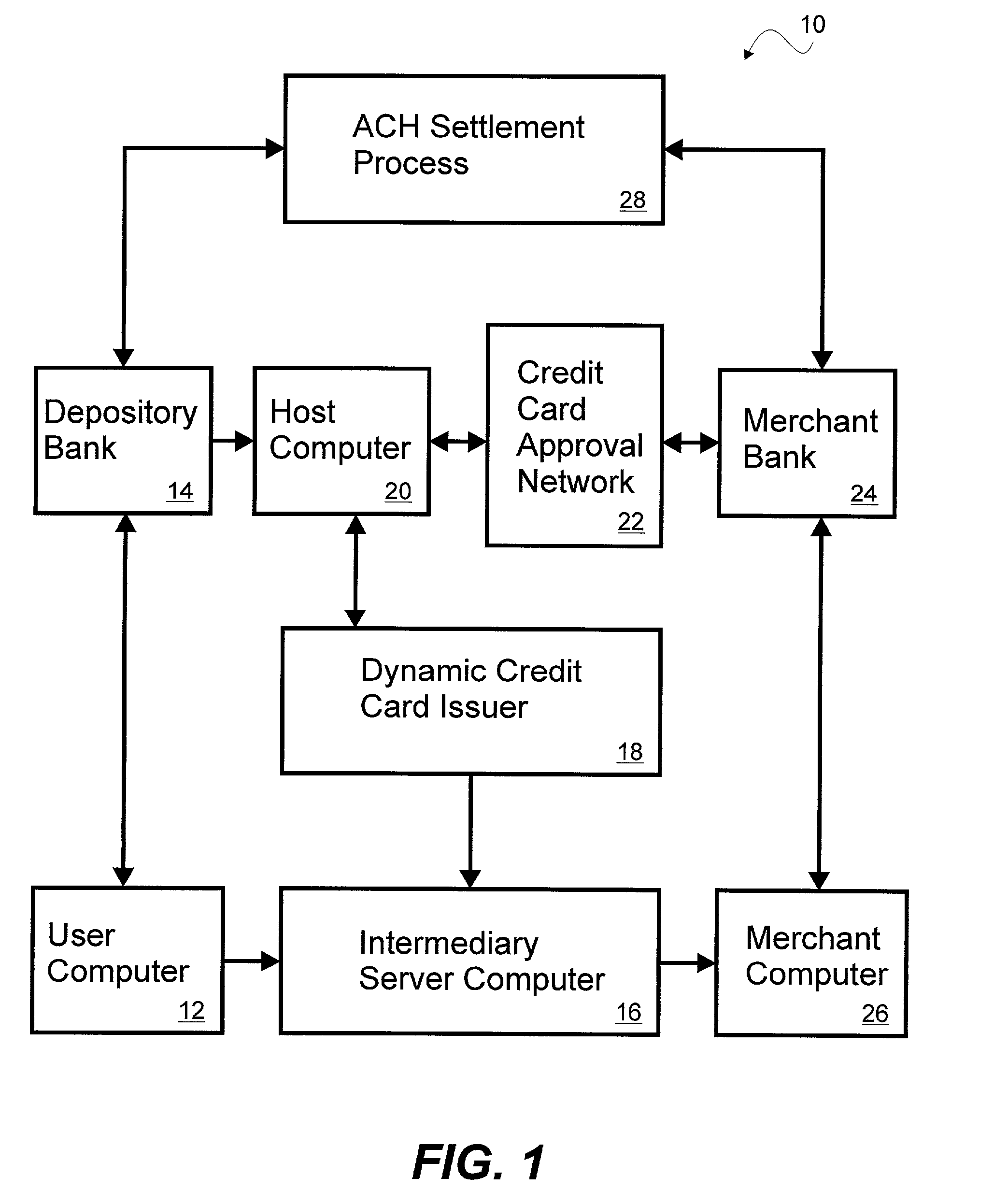

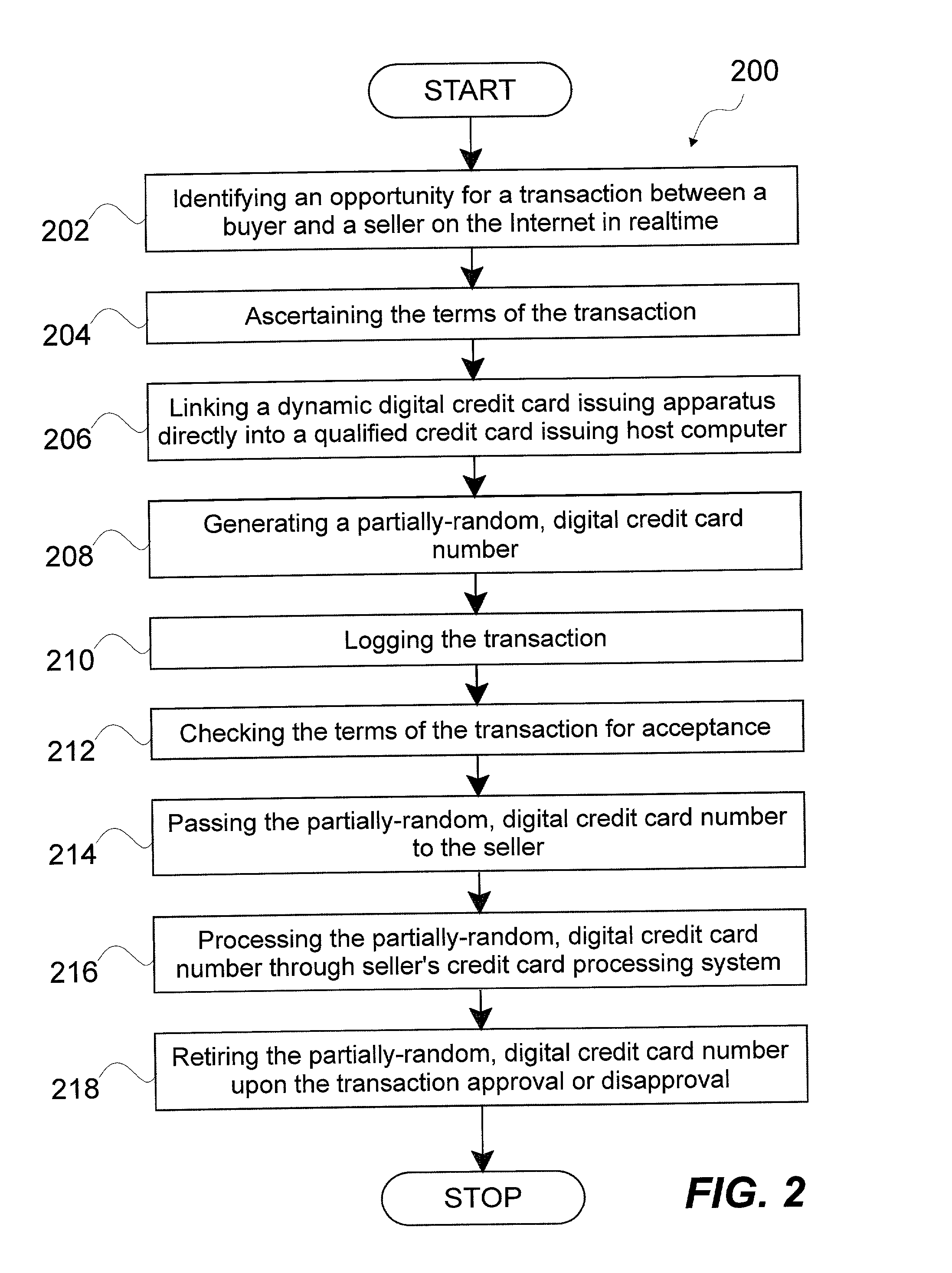

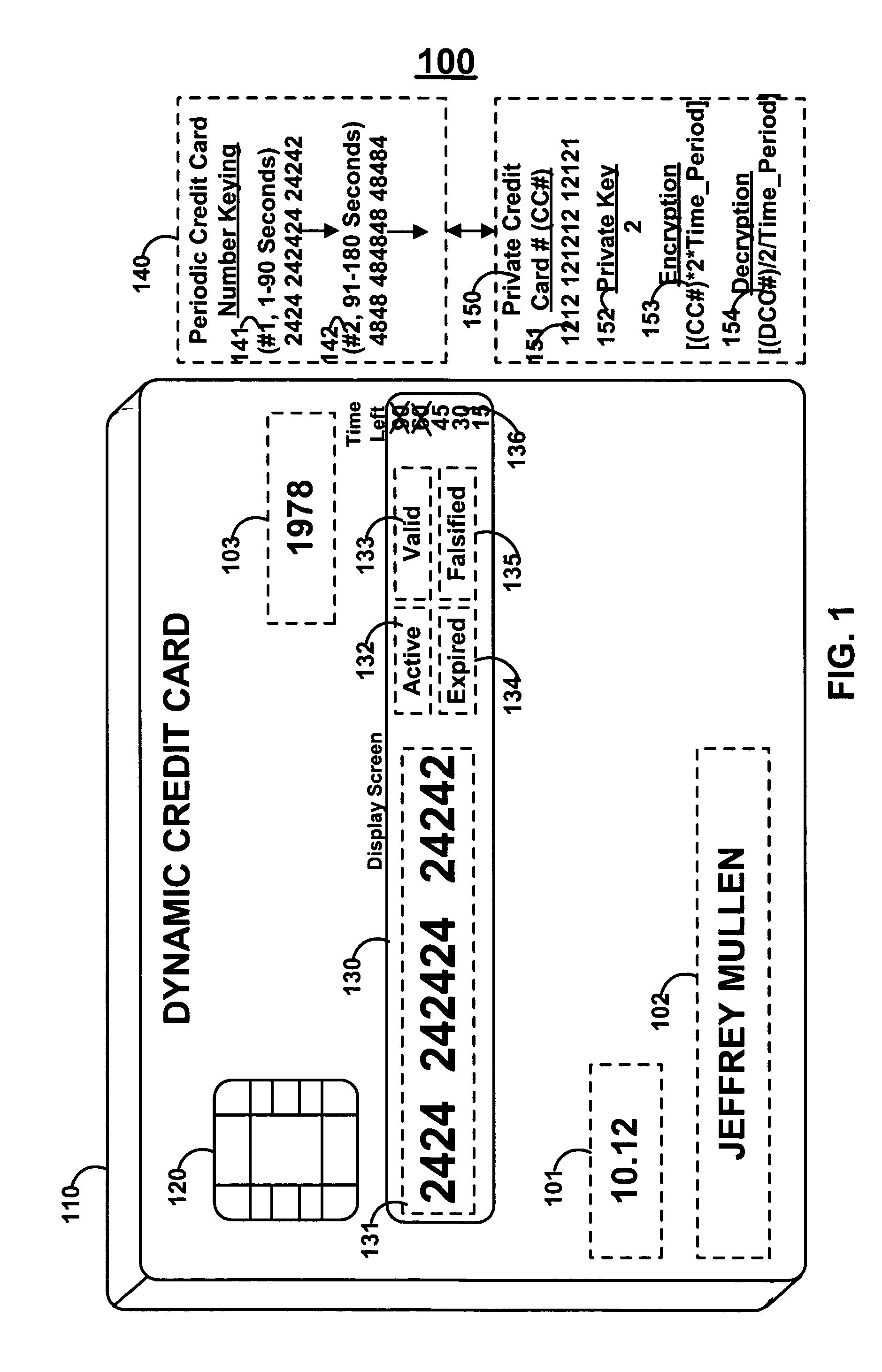

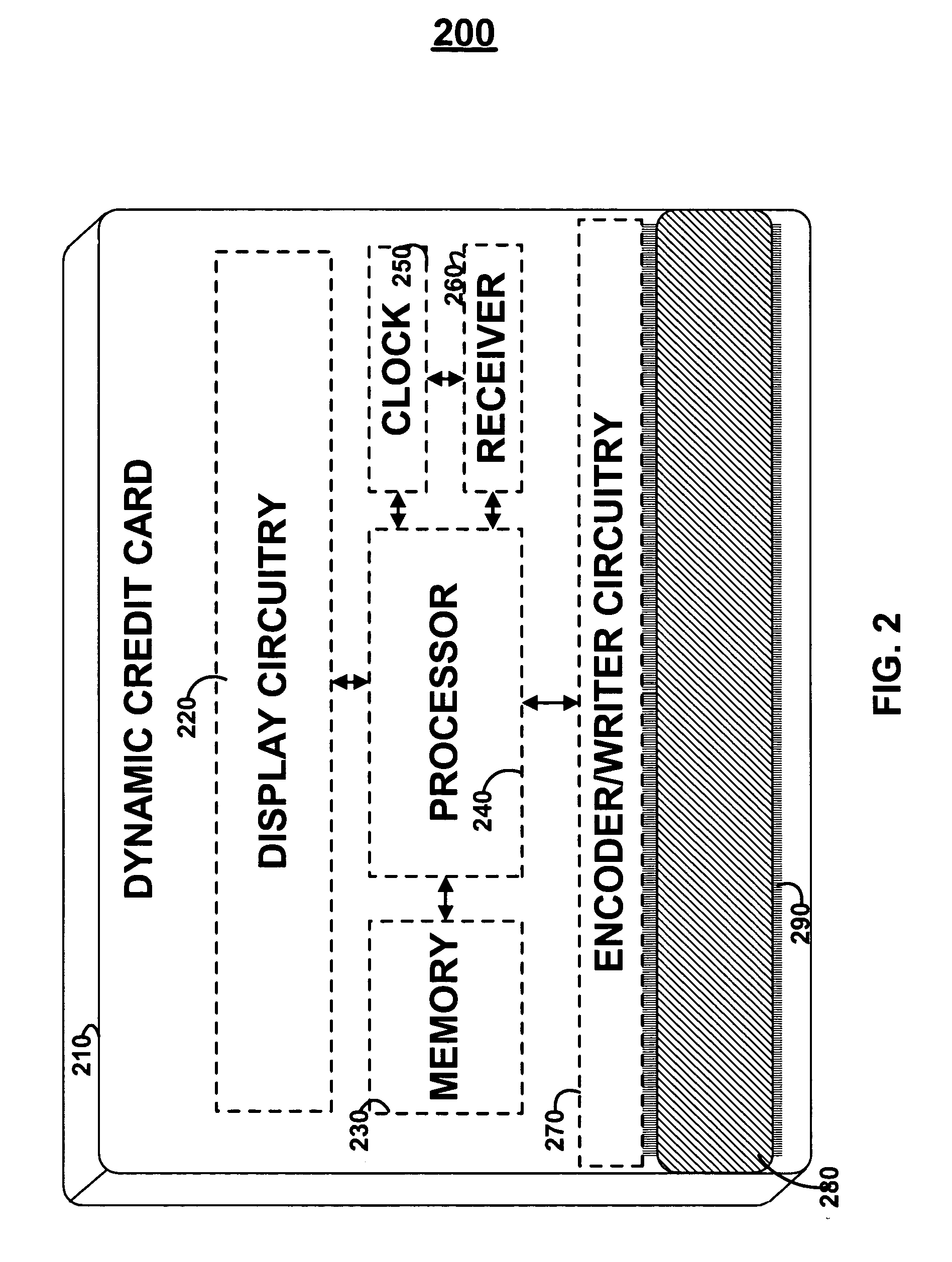

System and method for dynamically issuing and processing transaction specific digital credit or debit cards

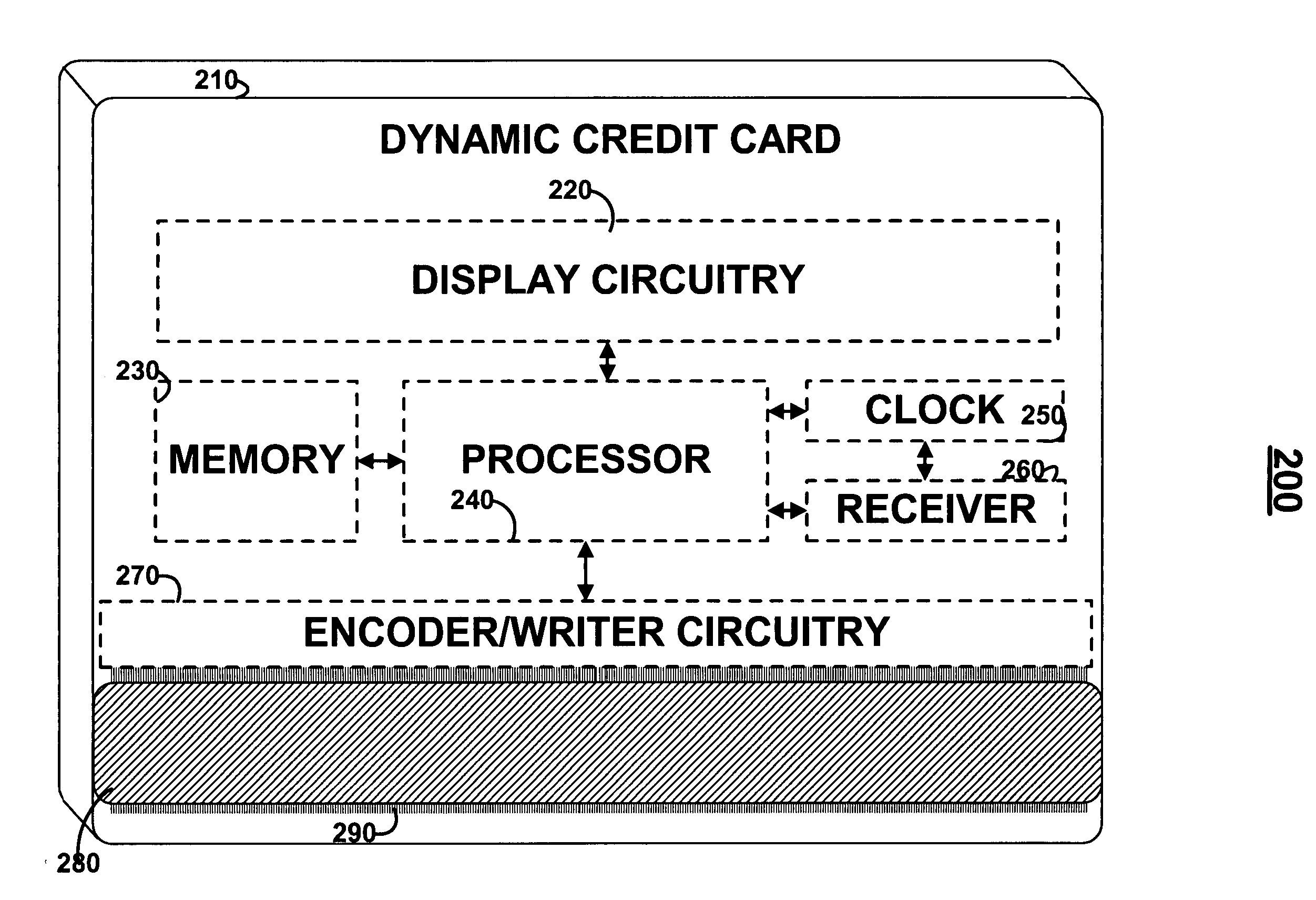

A system and method of dynamically issuing credit card numbers and processing transactions using those credit card numbers is disclosed. A method according to the invention includes digitally recognizing a transaction opportunity on the Internet in real-time, recognizing the terms of the transaction, linking a dynamic digital credit card issuing apparatus directly into a qualified credit card issuing host, generating a partially random digital credit card number, logging the transaction, checking the terms of the transaction for acceptance, passing the dynamically issued digital credit card number to the merchant, processing the digital credit card number through the merchant's card processing system, receiving the transaction approval request, participating in credit card validity checking systems, processing the approval request in real-time, sending the requesting party a legitimate authorization code, and retiring the digital credit card number immediately upon transaction approval or disapproval. A system according to the invention implements the method of the invention.

Owner:ORANGATANGO

Transaction system

InactiveUS6236981B1Improve securityImprove the level ofUser identity/authority verificationComputer security arrangementsService provisionThe Internet

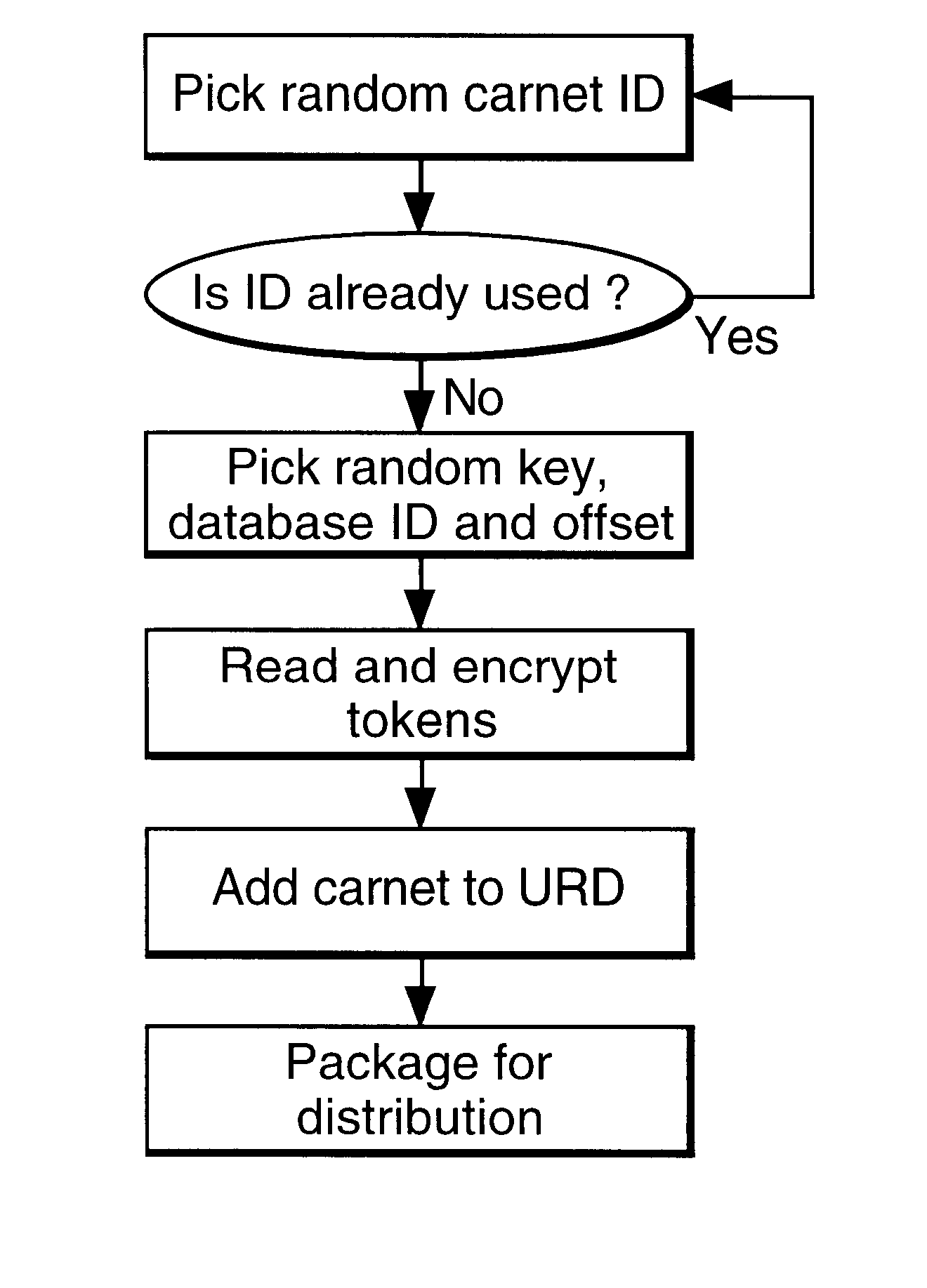

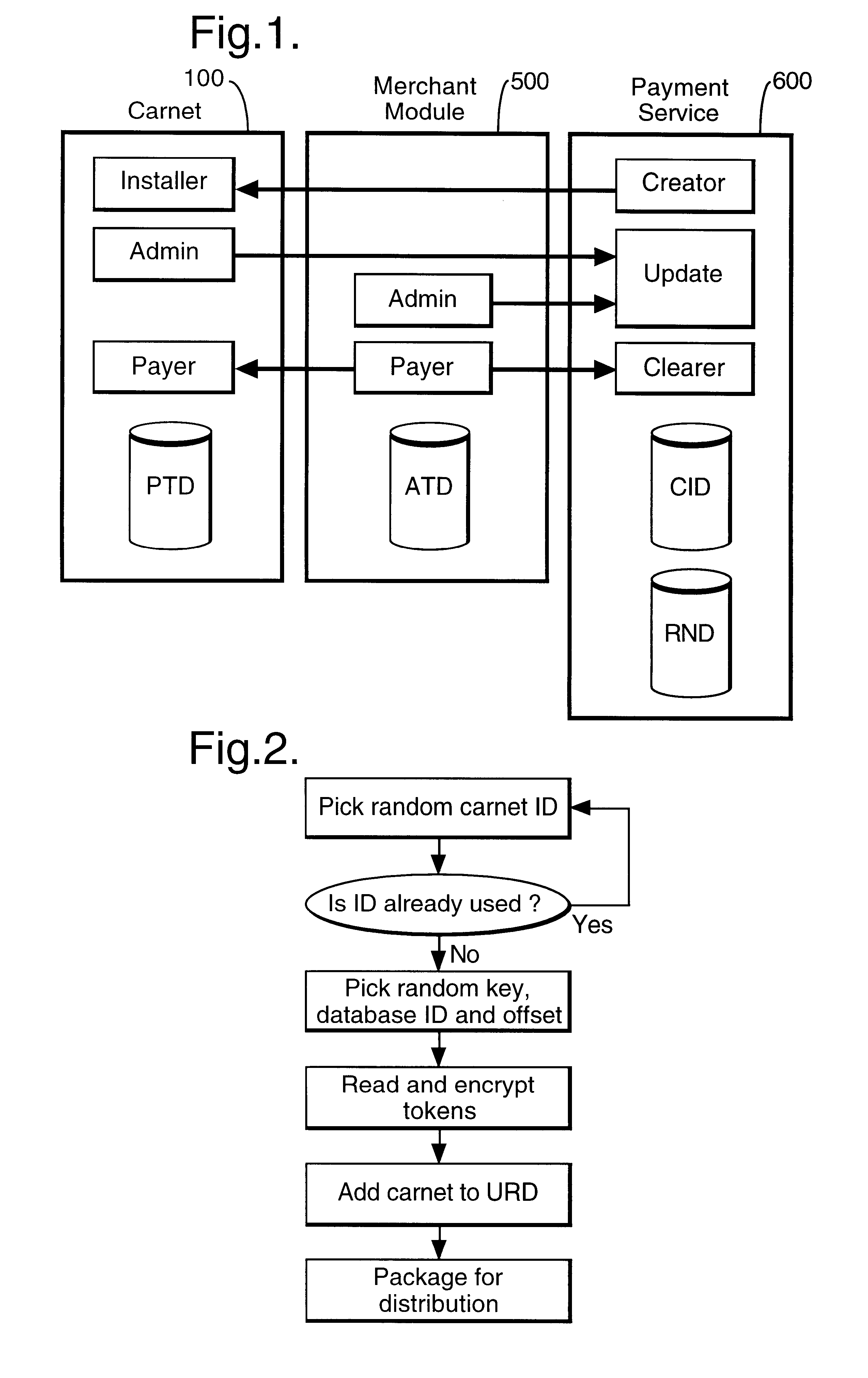

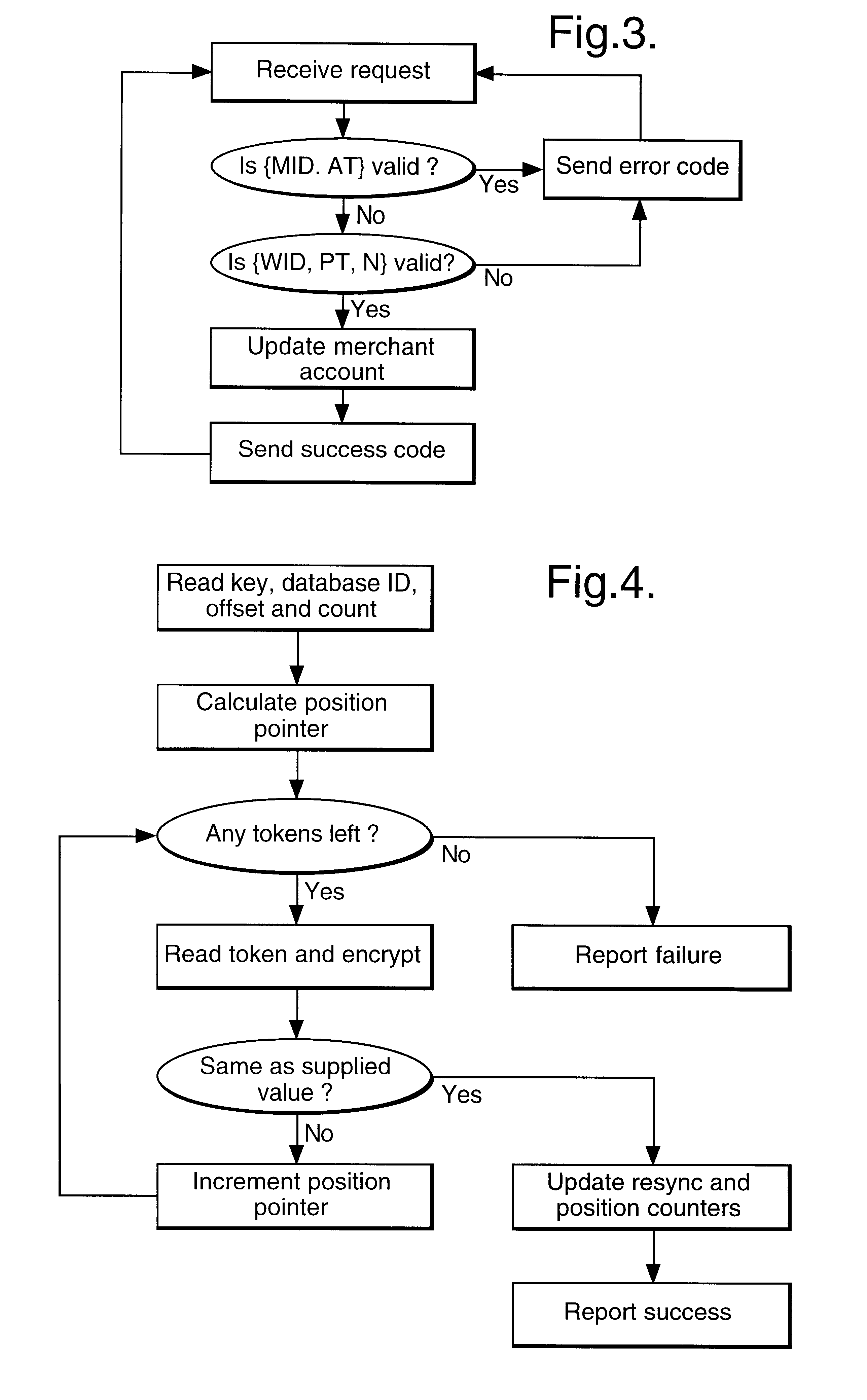

In a digital payment system, a sequence of random numbers is stored at a payment service. A set of digitally encoded random numbers derived from the stored sequence is issued to the user in return for payment. The tokens are stored in a Carnet. The user can then spend the tokens by transferring tokens to a merchant, for example, to an on-line service provider. The merchant returns each token received to the payment server. The payment server authenticates the token and transmits an authentication message to the merchant. The merchant, payment server and user may be linked by internet connections.

Owner:BRITISH TELECOMM PLC

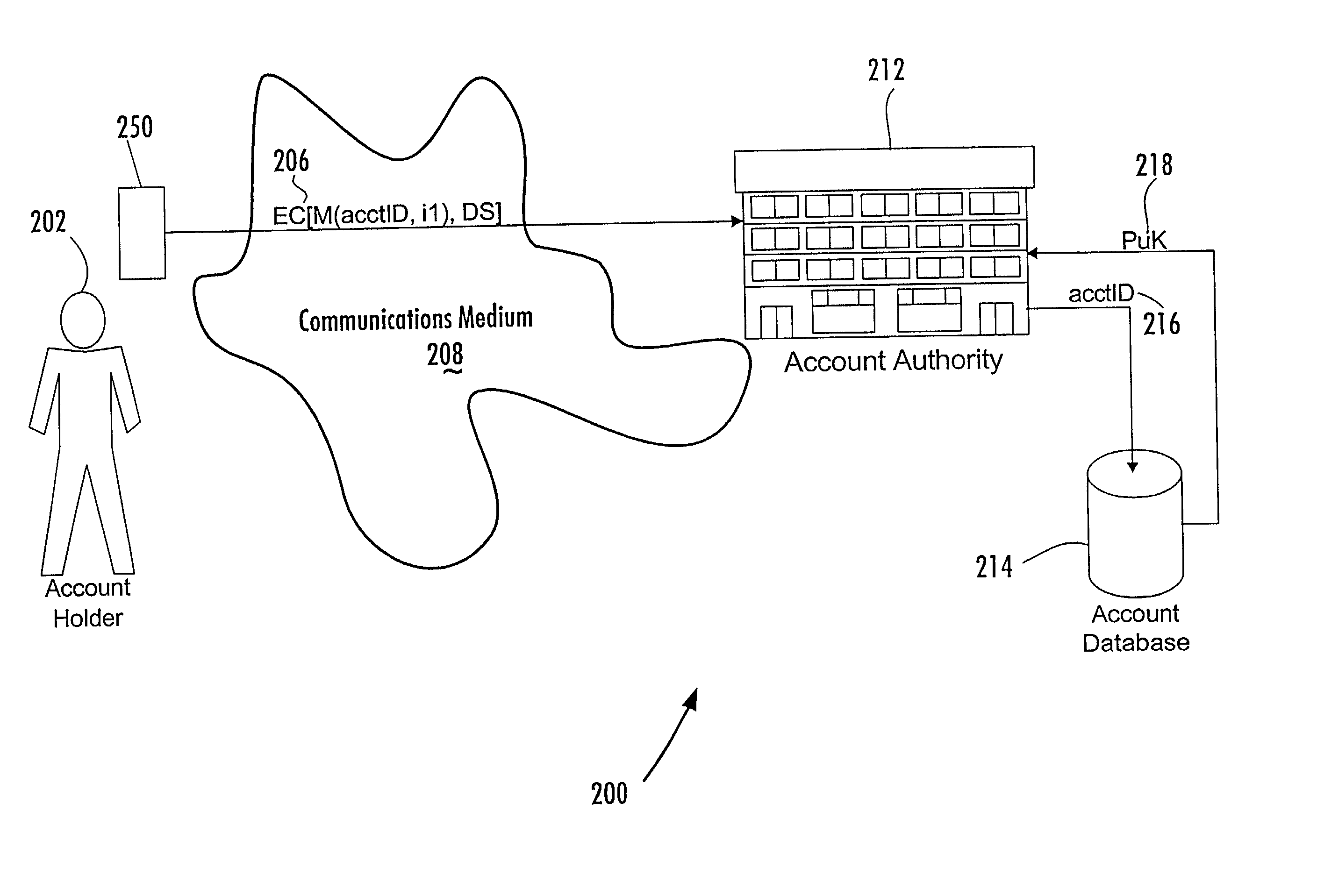

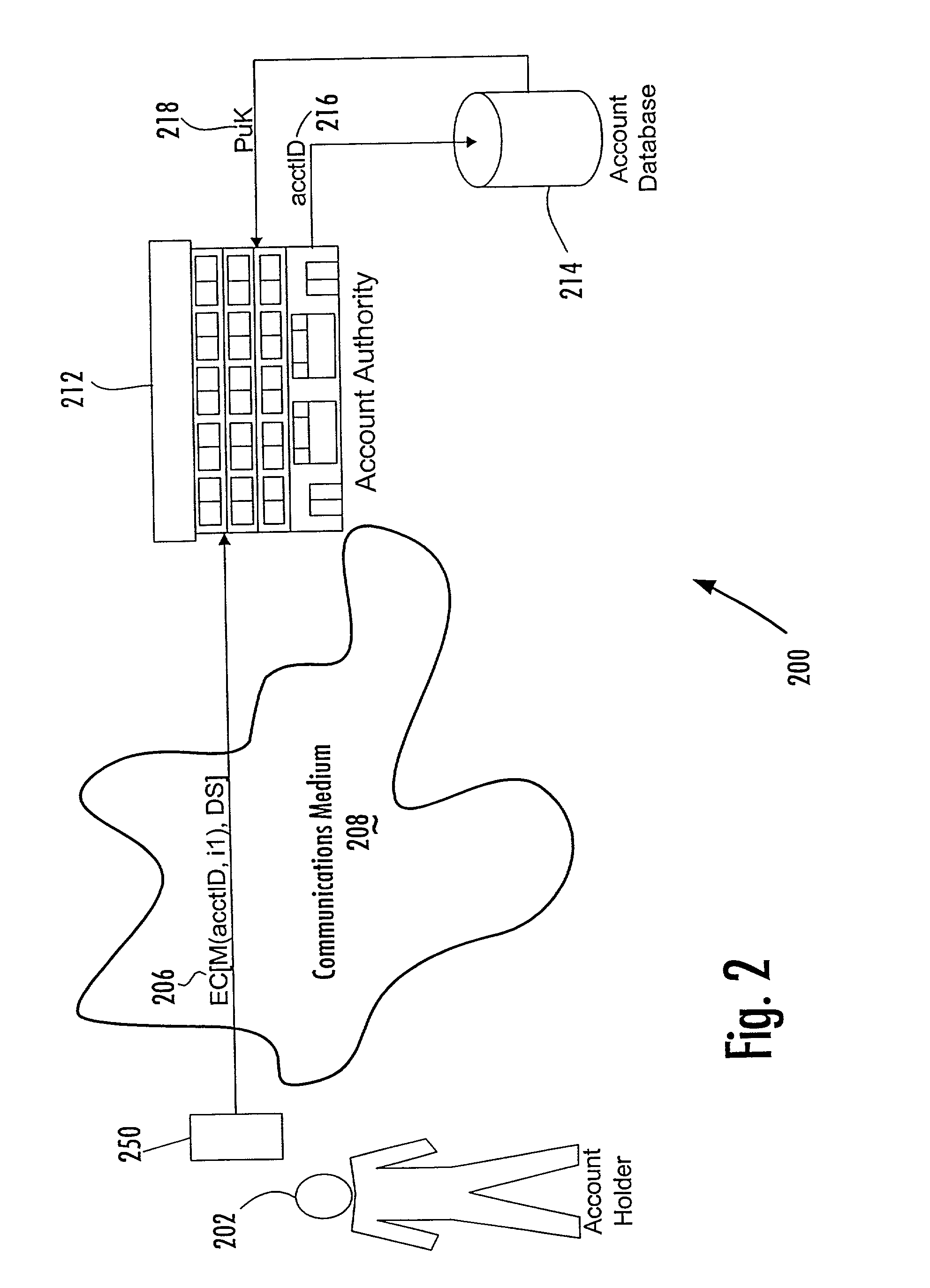

Account-based digital signature (ABDS) system

InactiveUS20020026575A1Key distribution for secure communicationFinanceDigital signatureElectronic communication

A method of authenticating an entity by a receiving party with respect to an electronic communication that is received by the receiving party and that includes both a unique identifier associated with an account maintained by the receiving party and a digital signature for a message regarding the account, consists of the steps of, before receipt of the electronic communication, first associating by the receiving party a public key of a public-private key pair with the unique identifier and, thereafter, only conducting message authentication using the digital signature received by the receiving party in the electronic communication and the public key associated with the account identifier.

Owner:FIRST DATA

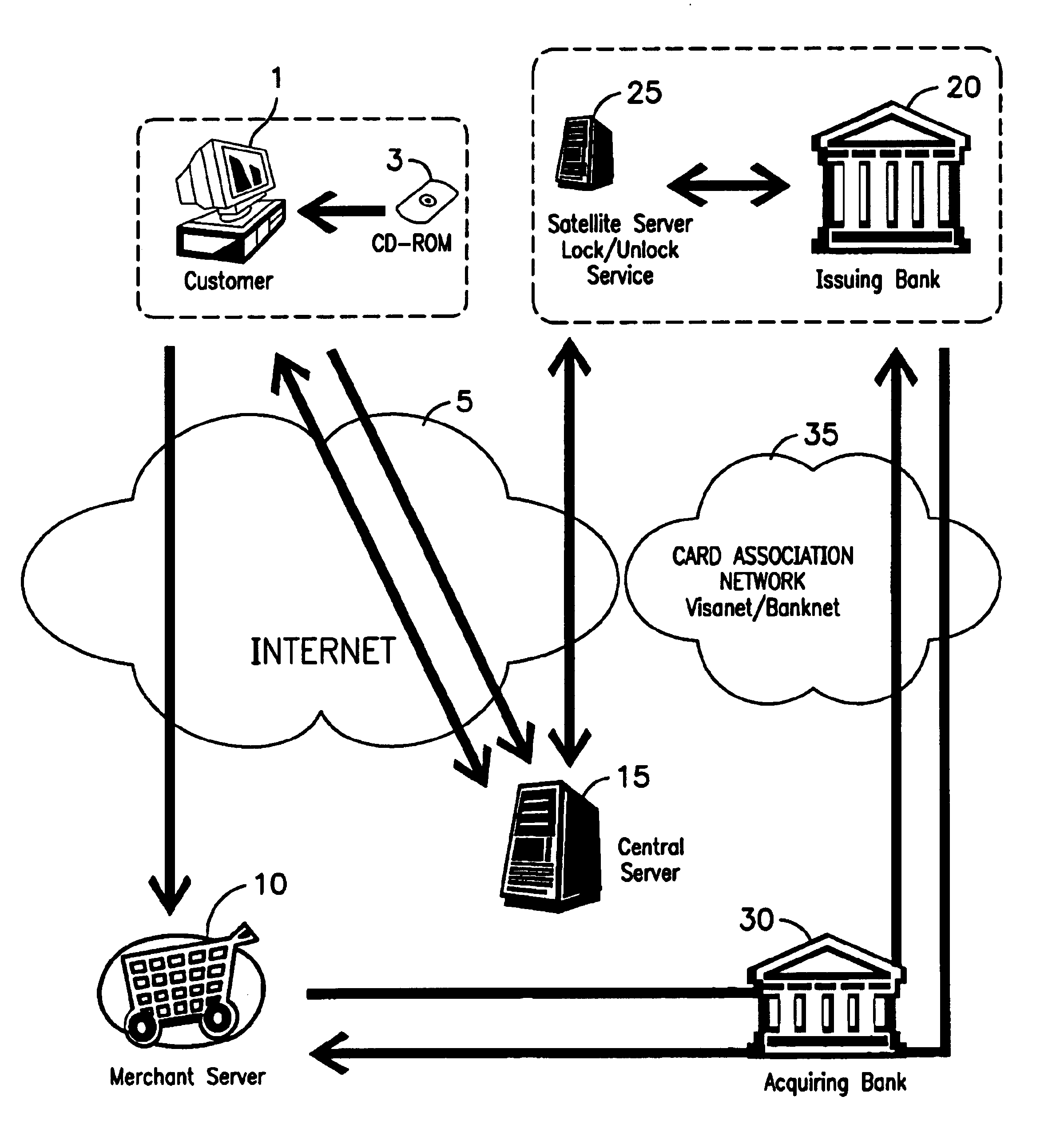

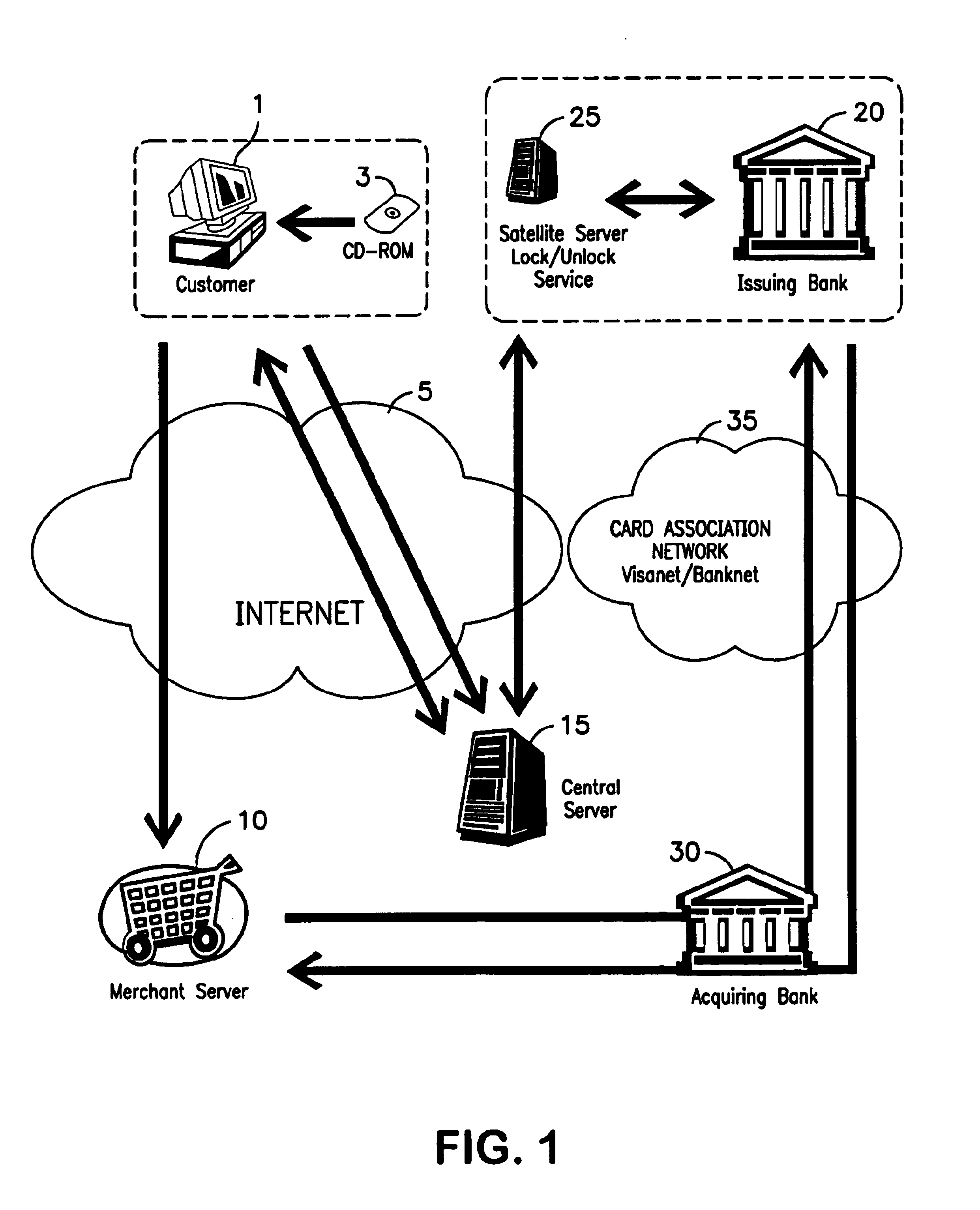

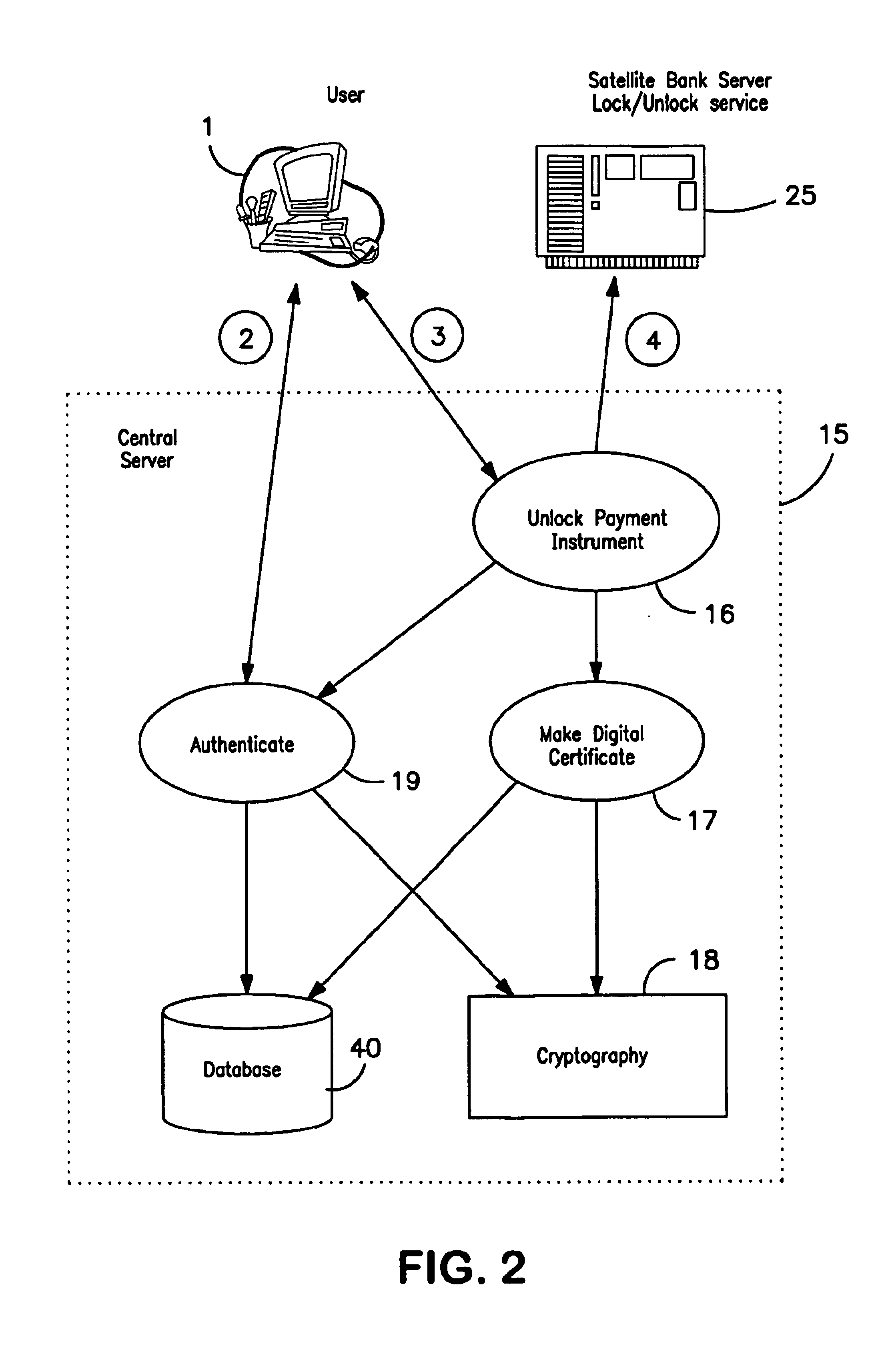

Payment instrument authorization technique

InactiveUS6931382B2Strong authenticationPayment circuitsSpecial data processing applicationsThird partyAuthorization

A method is provided for protecting a payment instrument in non-face-to-face transactions. The payment instrument is issued by an issuing entity and associated with an authorized instrument holder. The authorized instrument holder is subject to authentication by a trusted third party with whom the payment instrument holder has previously registered. The method includes: the authorized instrument holder communicating with the issuing entity to block, on a default basis, authorization of the payment instrument for non-face-to-face transactions unless authorized to unblock the payment instrument by the trusted third party; prior to a non-face-to-face transaction, the authorized instrument holder communicating with the trusted third party to subject him or herself to authentication and to request that the payment instrument be unblocked; and the trusted third party authenticating the authorized instrument holder, and if the authentication result is positive, communicating with the issuing entity to request unblocking of the payment instrument.

Owner:KIOBA PROCESSING LLC

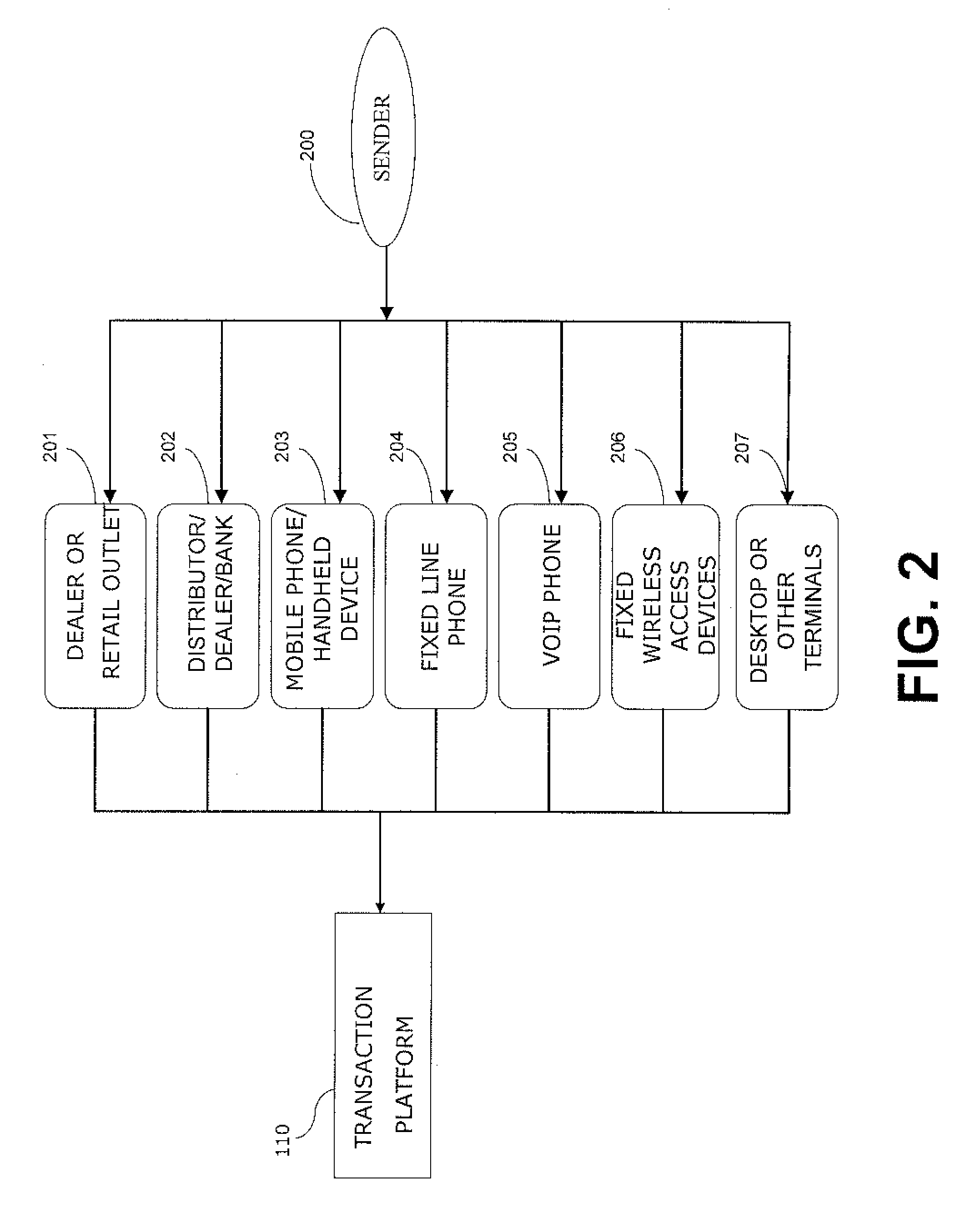

Apparatus and method for facilitating money or value transfer

An apparatus and method for transferring money or value, using a wide range of interfaces to initiate a transfer and a wide range of options for receiving the transfer, including receiving the transferred sum directly to the communication device / account of the receiver. The receiver can use the transferred sum as an airtime credit, to obtain cash or to pay for other goods or services.

Owner:HIP CONSULT

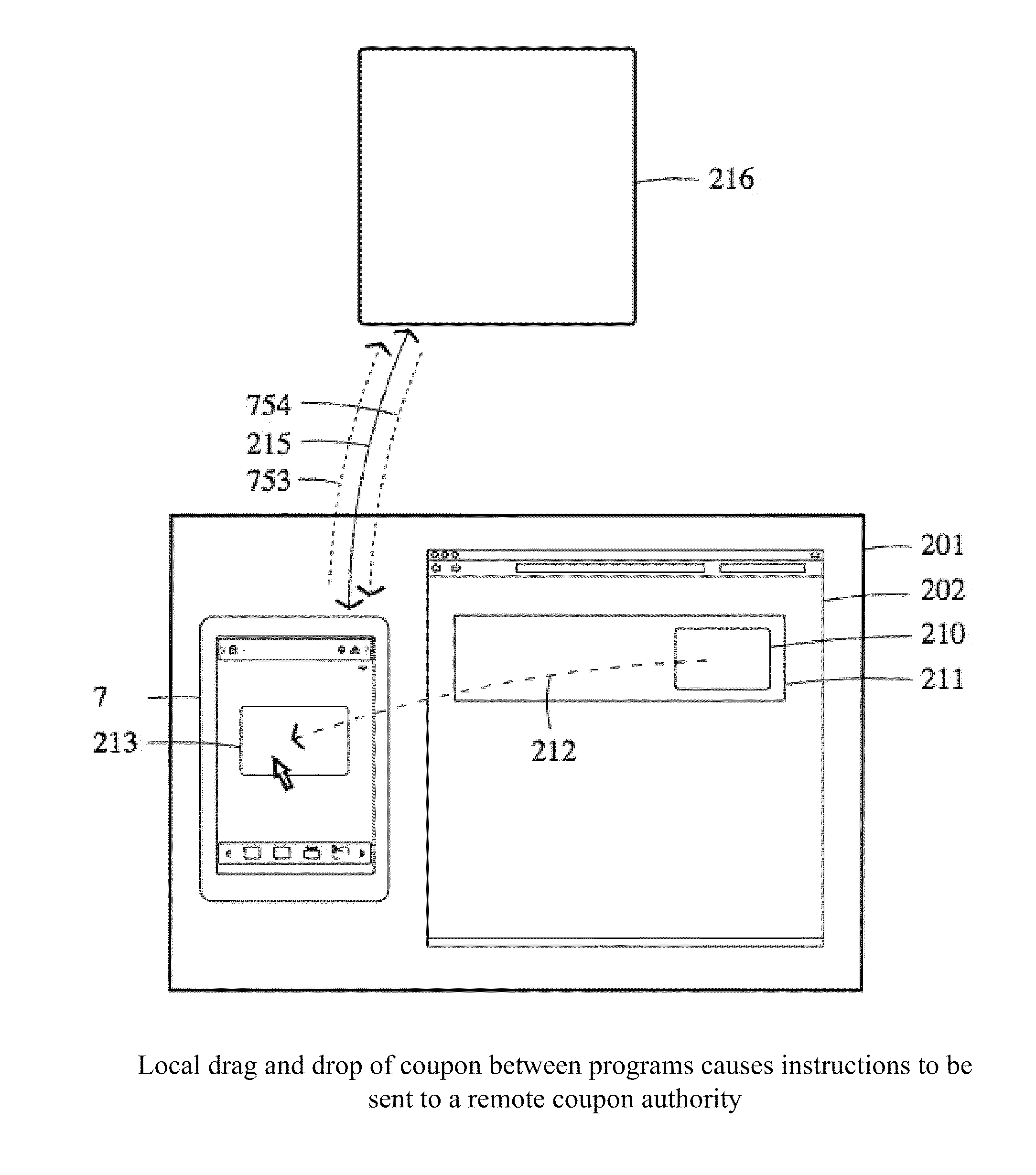

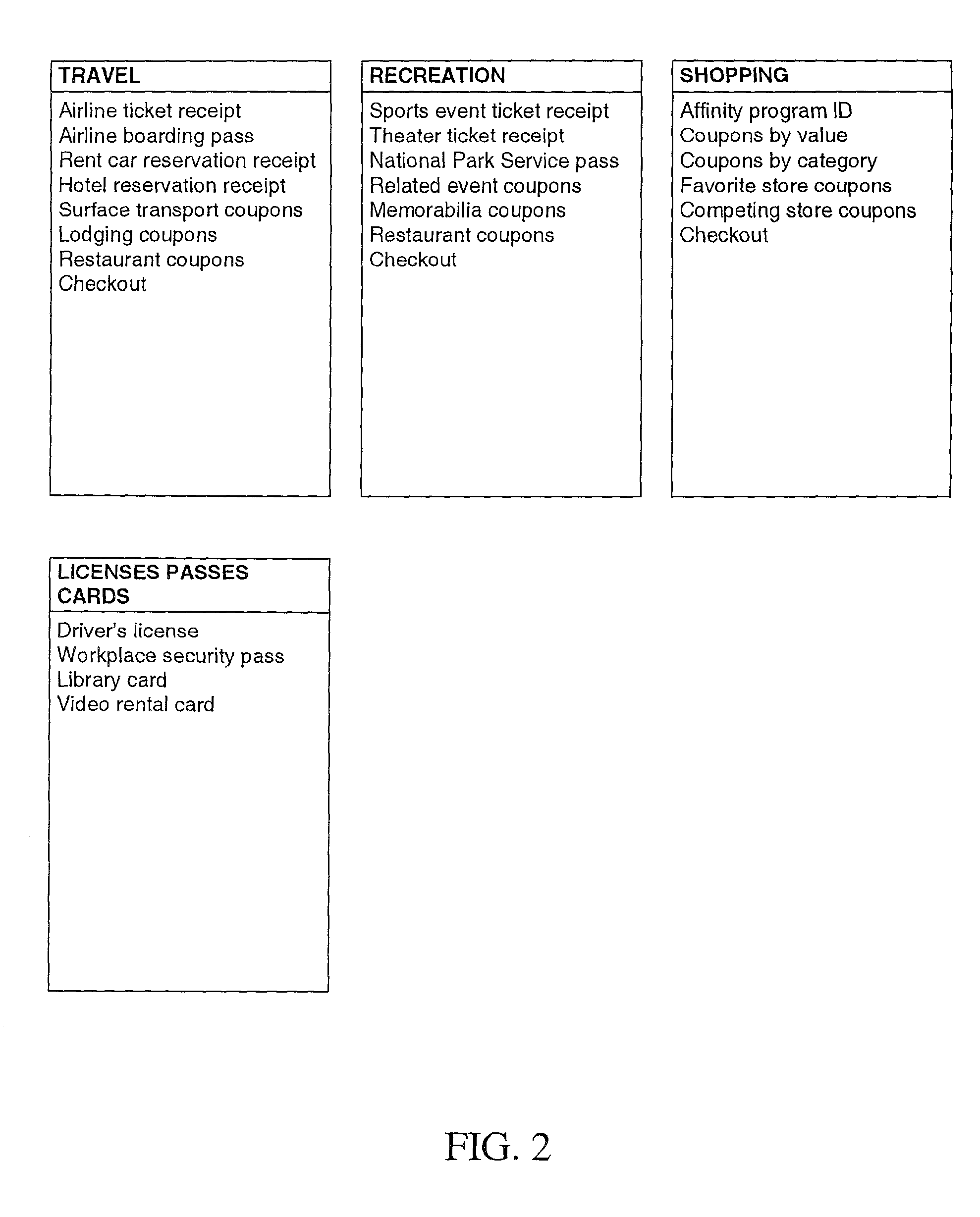

Dispensing digital objects to an electronic wallet

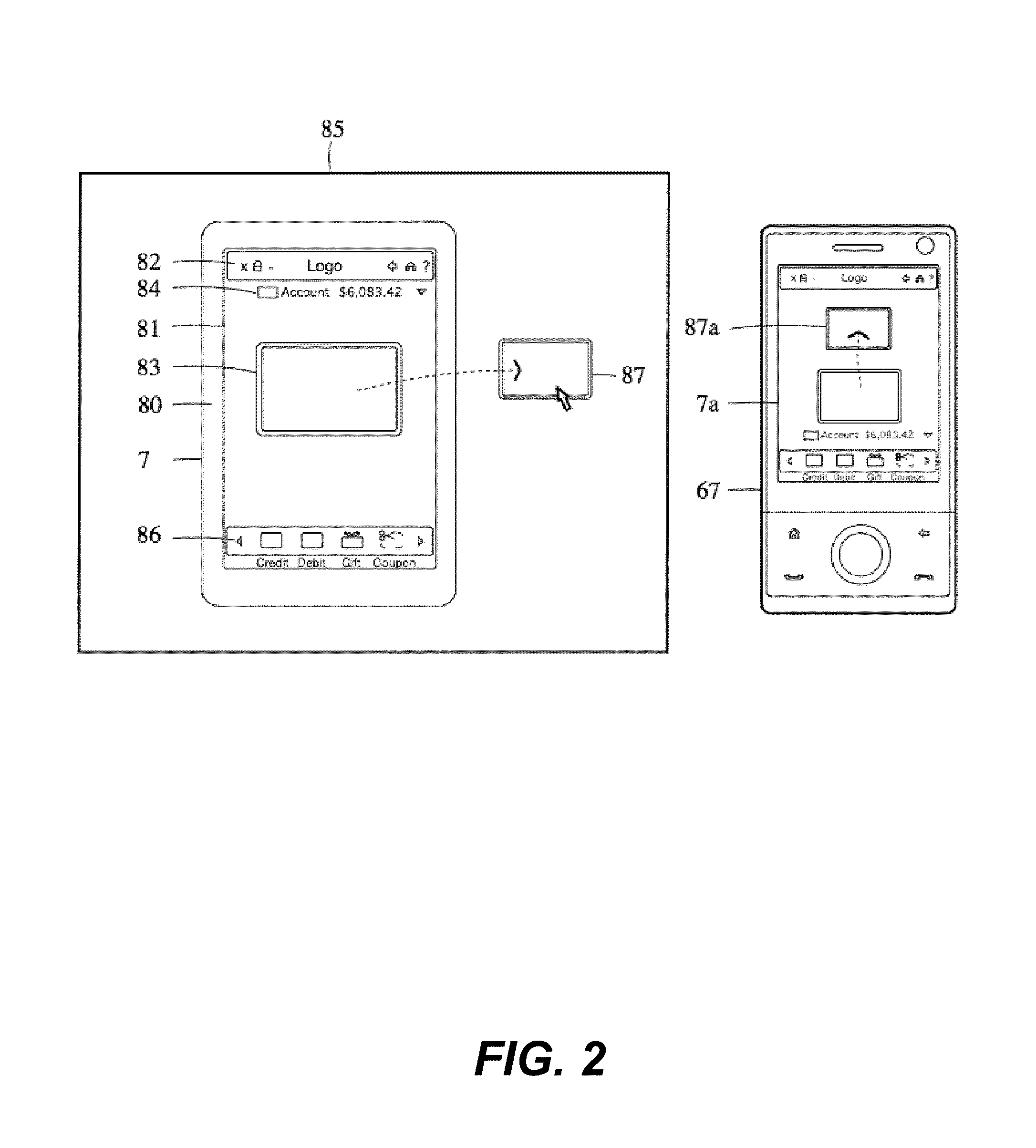

A configuration system and method is disclosed that includes a unified and integrated configuration that is composed of a payment system, an advertising system, and an identity management system such that the unified system has all of the benefits of the individual systems as well as several additional synergistic benefits. Also described are specific configurations including the system's access point architecture, visual wallet simulator user interface, security architecture, coupon handling as well as the system's structure and means for delivering them as targeted advertising, business card handling, membership card handling for the purposes of login management, receipt handling, and the editors and grammars provided for customizing the different types of objects in the system as well as the creation of new custom objects with custom behaviors. The configurations are operable on-line as well as through physical presence transactions.

Owner:GOOGLE LLC

Method and apparatus for acquiring, maintaining, and using information to be communicated in bar code form with a mobile communications device

InactiveUS20020060246A1Convenient acquisition and maintenance and useCharacter and pattern recognitionIndividual entry/exit registersBarcodeCommunication device

A user is provided with a secure database containing information in diverse categories that relates to the user and that may be represented at least in part in bar code form and communicated with light from a mobile communications device. The diverse information is obtained from any combination of a variety of vendor and governmental computer systems, internet service providers, and communications devices. The user has access to the database using a mobile communications device for displaying, managing, and entering information, and for communicating information in bar code form with light. The user first selects the category that contains the specific item of information, and then selects the specific item of information. The specific item of information then is communicated in bar code form with light from the mobile communications device for scanning by a bar code scanner to obtain the desired good or service.

Owner:SAMSUNG ELECTRONICS CO LTD

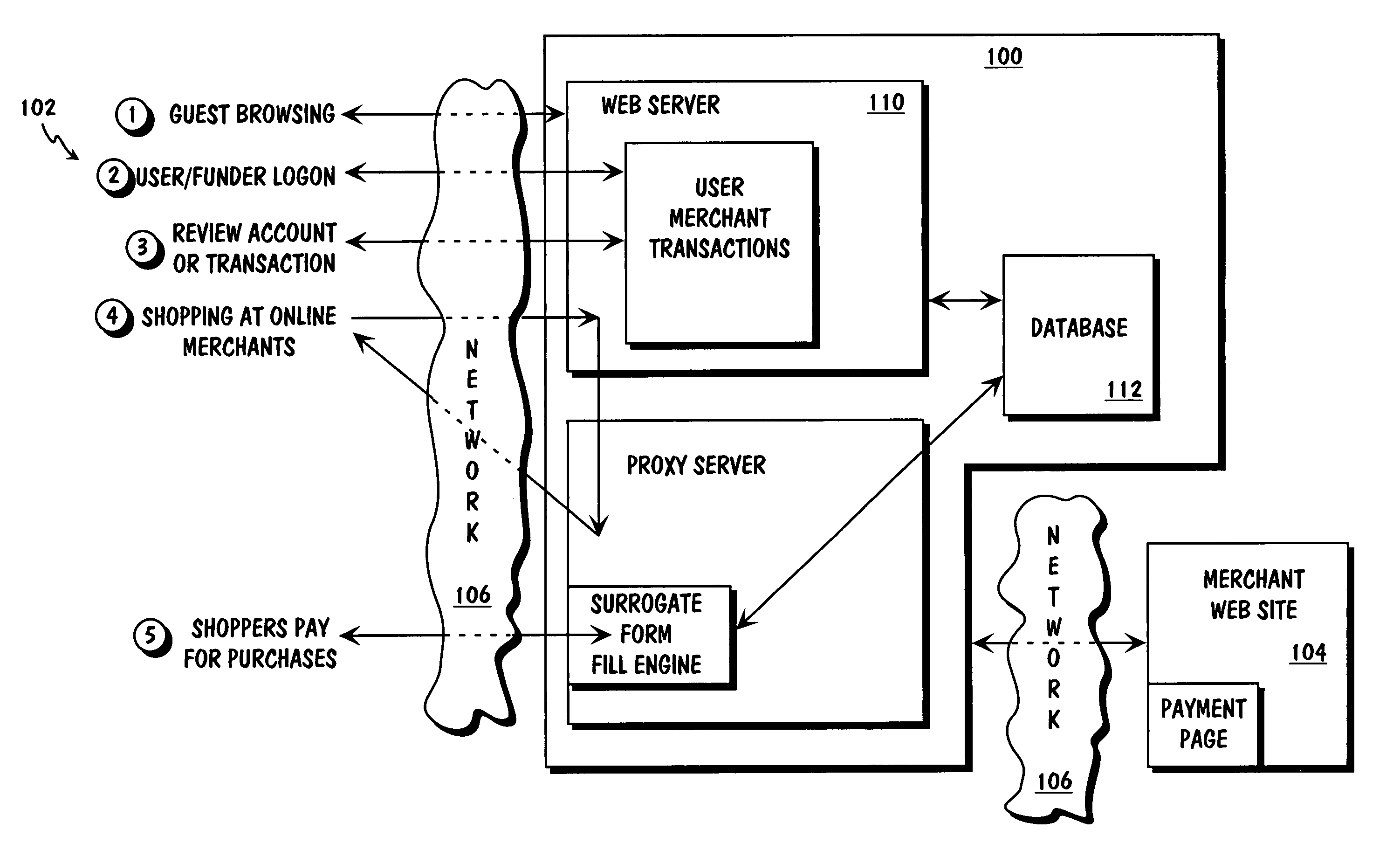

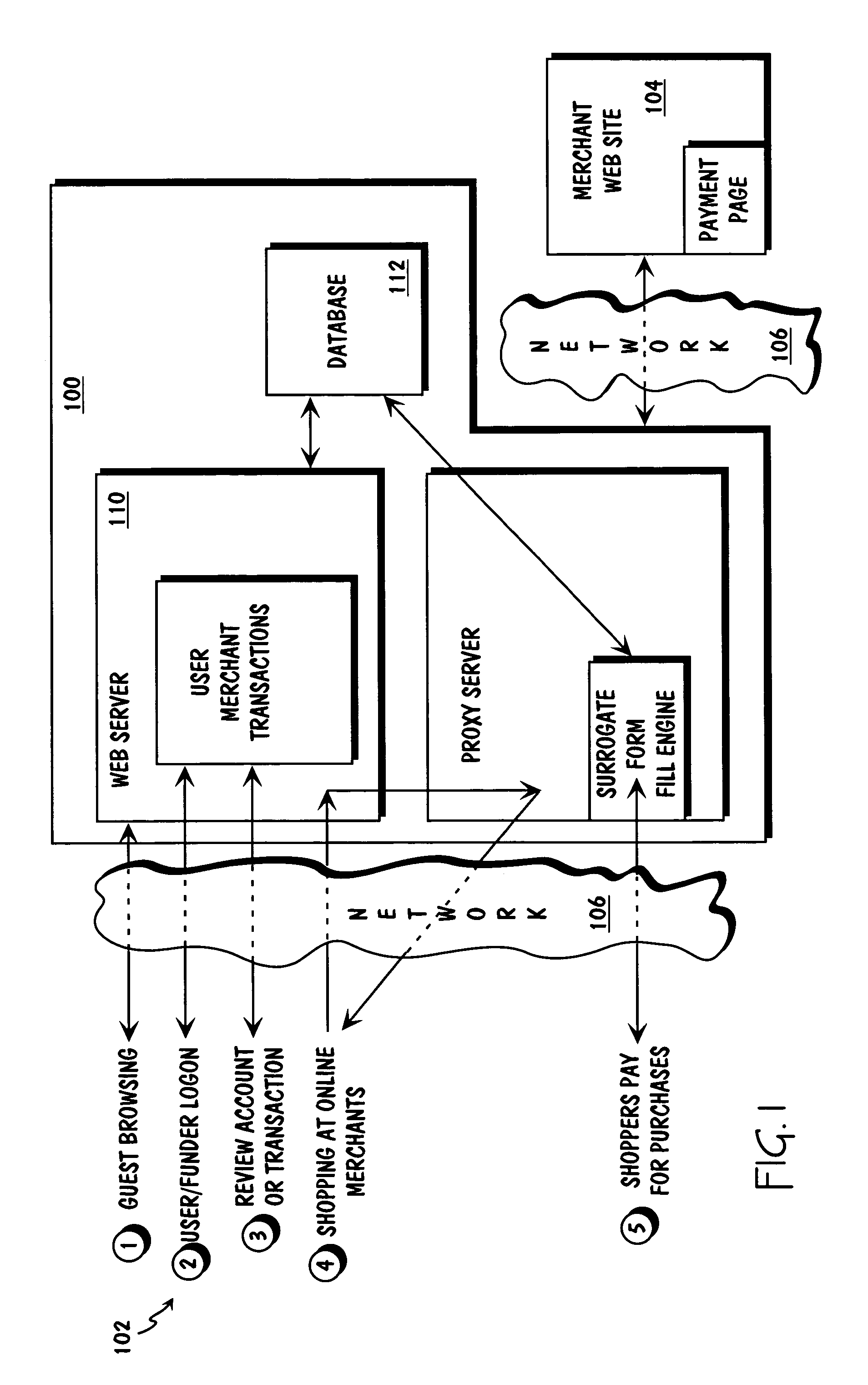

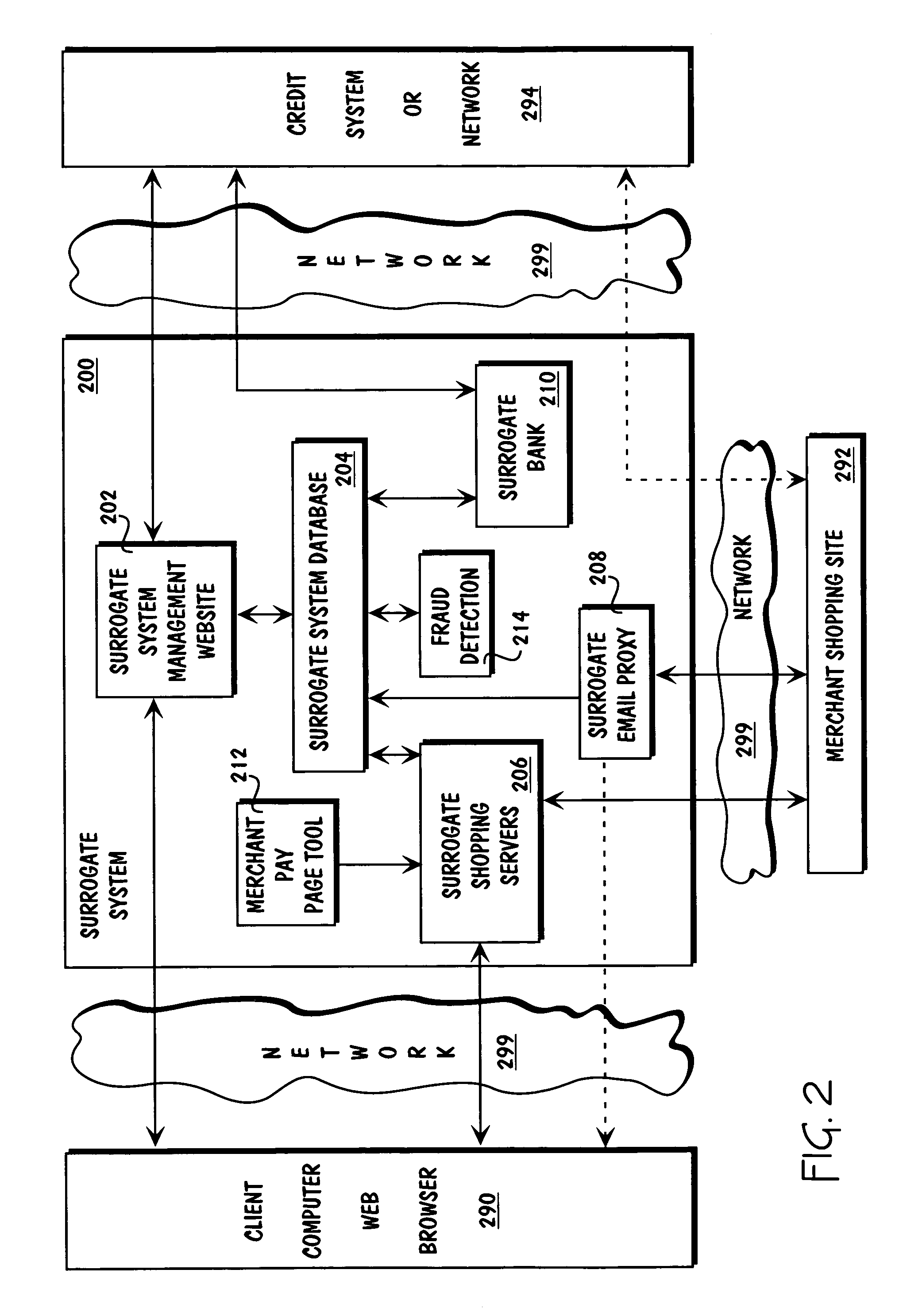

Method and apparatus for surrogate control of network-based electronic transactions

A surrogate system for the transparent control of electronic commerce transactions is provided through which an individual without a credit card is enabled to shop at online merchant sites. Upon opening an account within the surrogate system, the account can be funded using numerous fund sources, for example credit cards, checking accounts, money orders, gift certificates, incentive codes, online currency, coupons, and stored value cards. A user with a funded account can shop at numerous merchant web sites through the surrogate system. When merchandise is selected for purchase, a purchase transaction is executed in which a credit card belonging to the surrogate system is temporarily or permanently assigned to the user. The credit card, once loaded with funds from the user's corresponding funded account, is used to complete the purchase transaction. The surrogate system provides controls that include monitoring the data streams and, in response, controlling the information flow between the user and the merchant sites.

Owner:THE COCA-COLA CO

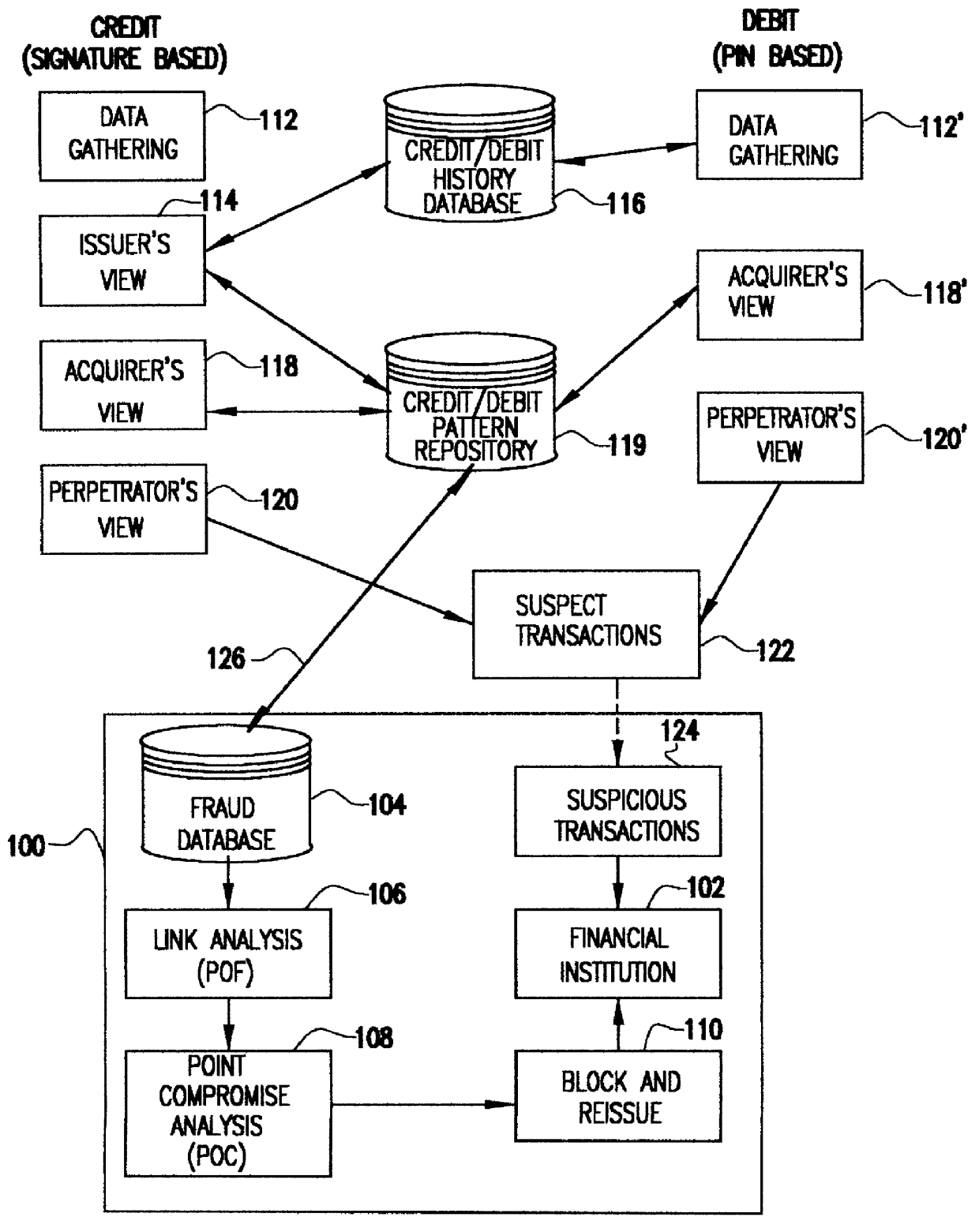

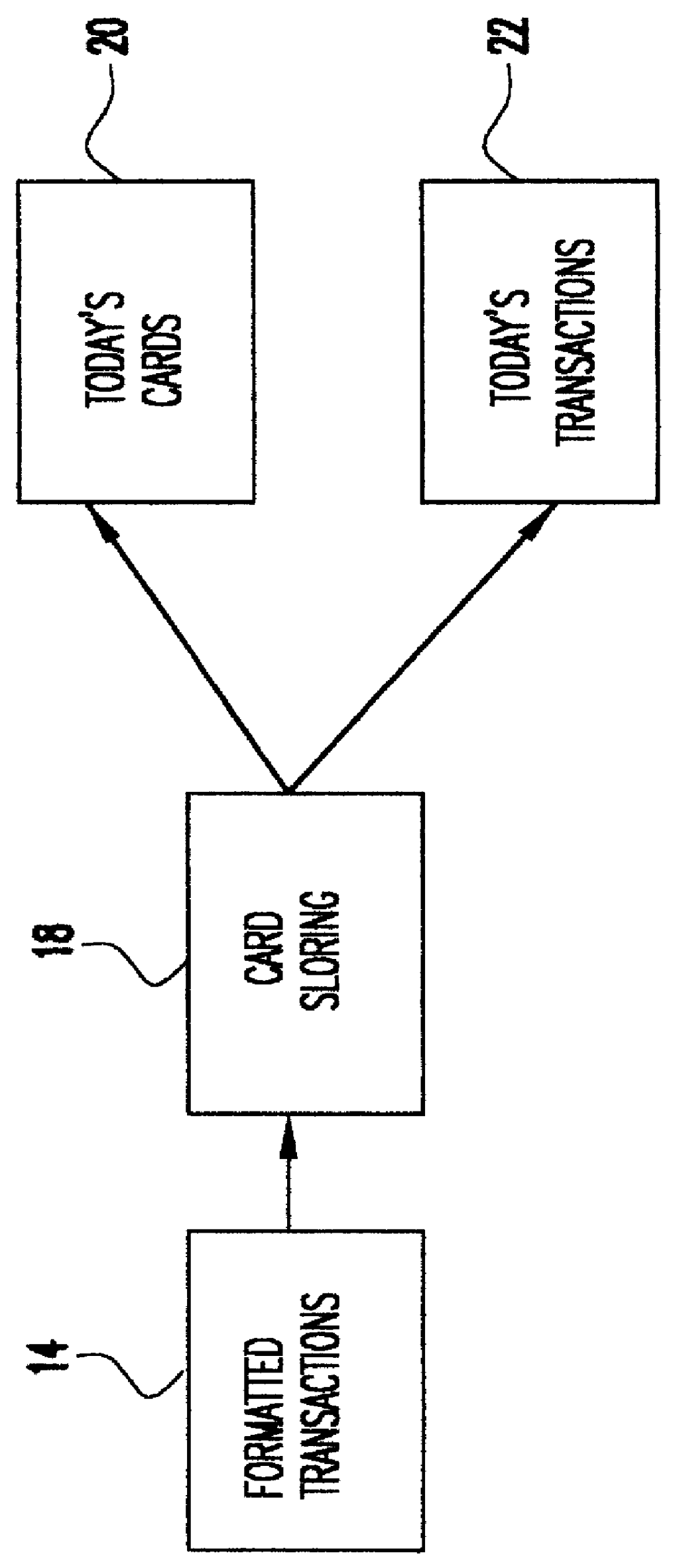

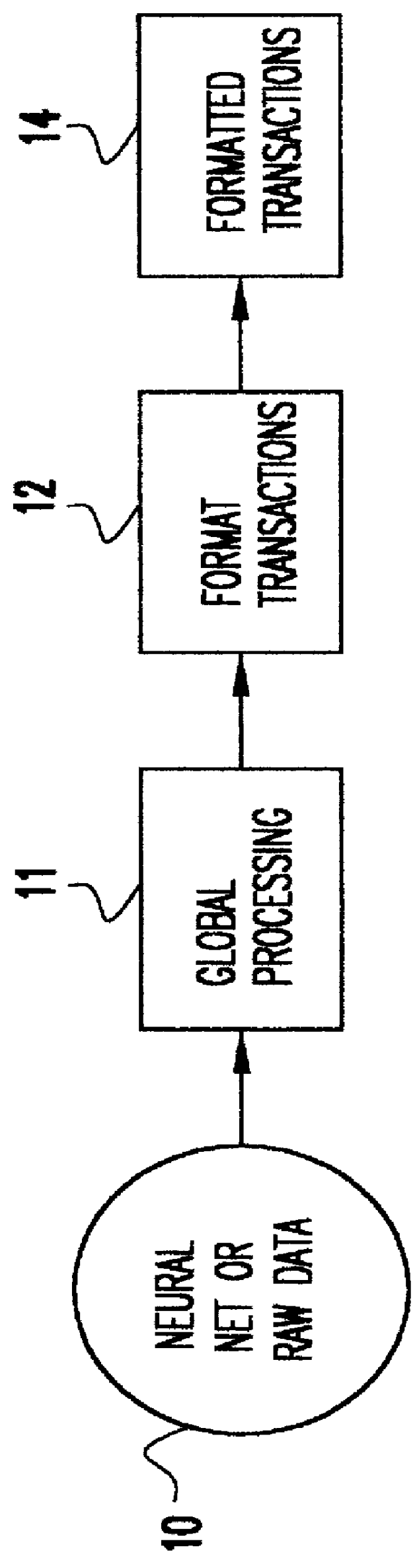

System for detecting counterfeit financial card fraud

Counterfeit financial card fraud is detected based on the premise that the fraudulent activity will reflect itself in clustered groups of suspicious transactions. A system for detecting financial card fraud uses a computer database comprising financial card transaction data reported from a plurality of financial institutions. The transactions are scored by assigning weights to individual transactions to identify suspicious transactions. The geographic region where the transactions took place as well as the time of the transactions are recorded. An event building process then identifies cards involved in suspicious transactions in a same geographic region during a common time period to determine clustered groups of suspicious activity suggesting an organized counterfeit card operation which would otherwise be impossible for the individual financial institutions to detect.

Owner:FAIR ISAAC & CO INC

System and Method for Issuing and Using a Loyalty Point Advance

InactiveUS20090106112A1Convenient transactionComplete banking machinesFinanceLoyalty programComputer science

A system and method for spending loyalty points over a computerized network to facilitate a loyalty point transaction is disclosed. The system enables a participant of a loyalty program to accept an advance of loyalty point when a loyalty account balance is insufficient to make a desired purchase. An amount of loyalty points available as an advance to a participant is determined based on a number of criteria related to the participant, financial account activity, and loyalty account activity. The participant is allotted a predetermined length of time to earn or purchase enough loyalty points to repay the balance of advanced loyalty points. If, at the conclusion of such predetermined length of time, sufficient points have not been earned to offset the loyalty point advance, the participant is charged the currency value of each outstanding loyalty point. The participant may be assessed interest charges and / or fees at the time of the loyalty point advance, during reimbursement, or at the end of a time period for reimbursement.

Owner:LIBERTY PEAK VENTURES LLC

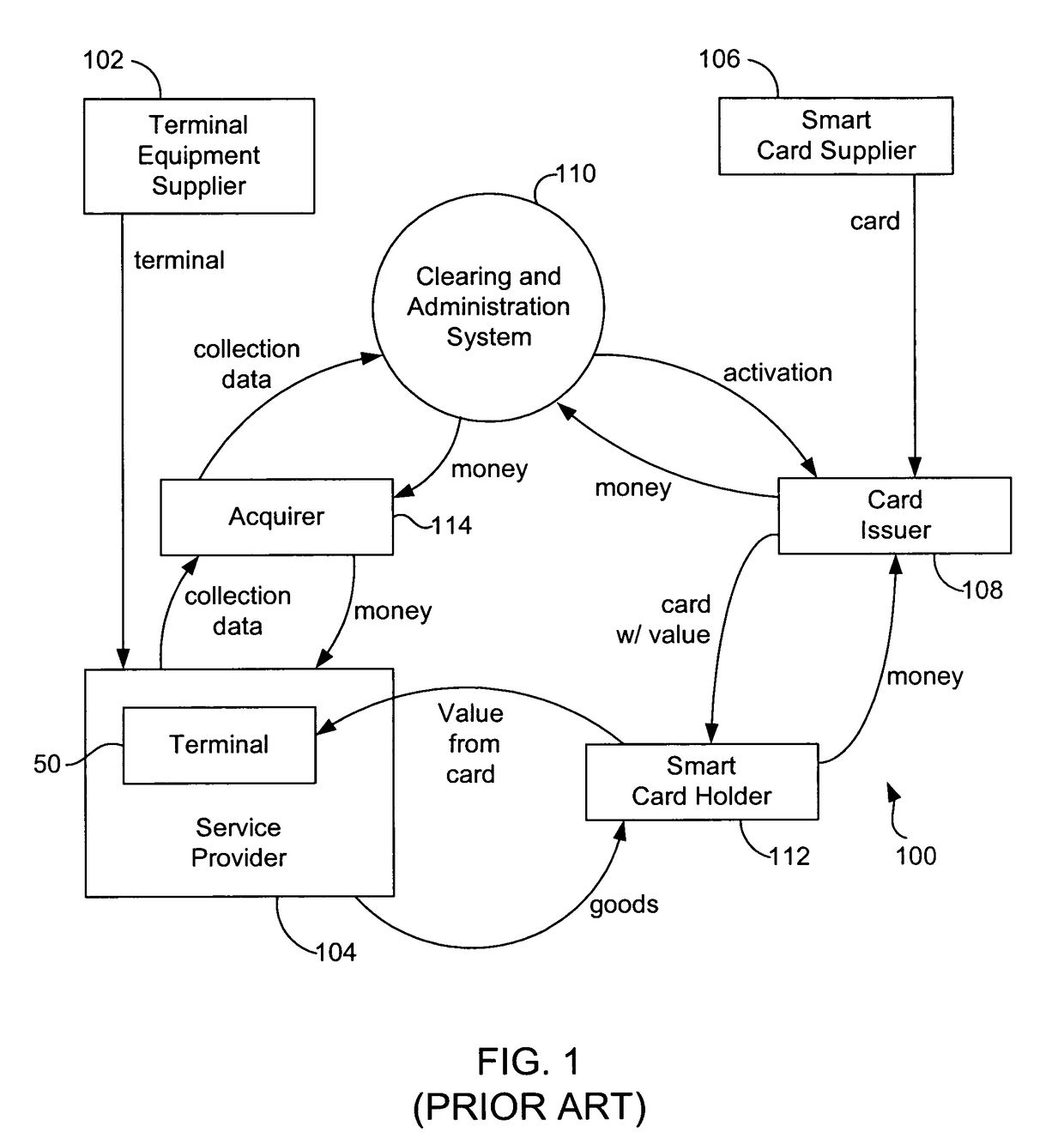

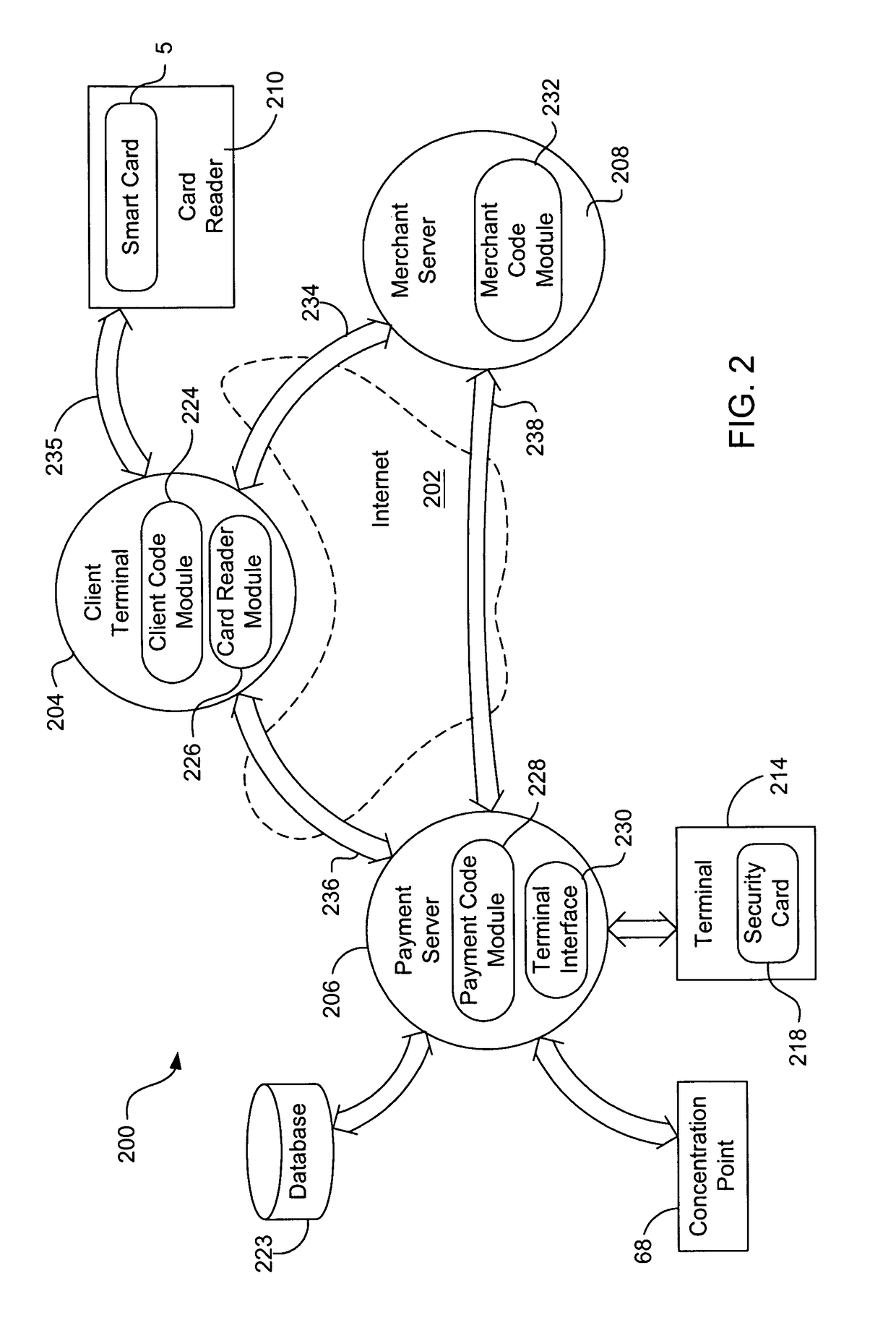

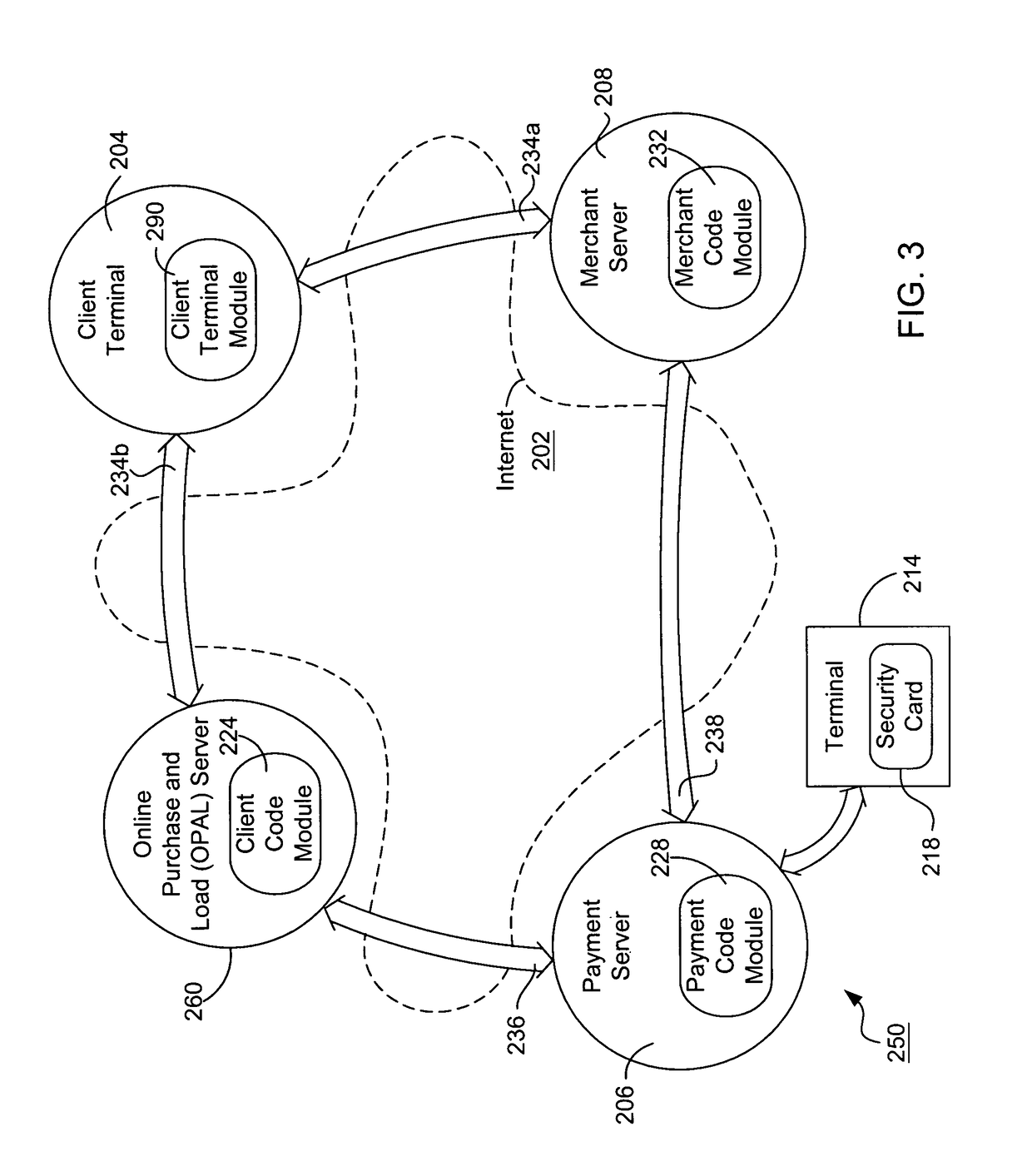

Internet payment, authentication and loading system using virtual smart card

InactiveUS7908216B1Advantageous for small dollar amount transactionMinimal timeFinancePayment circuitsMerchant servicesPayment

A system loads, authenticates and uses a virtual smart card for payment of goods and / or services purchased on-line over the Internet. An online purchase and load (OPAL) server includes a virtual smart card data base that has a record of information for each smart card that it represents for a user at the behest of an issuer. The server includes a smart card emulator that emulates a smart card by using the card data base and a hardware security module. The emulator interacts with a pseudo card reader module in the server that imitates a physical card reader. The server also includes a client code module that interacts with the pseudo card reader and a remote payment or load server. A pass-through client terminal presents a user interface and passes information between the OPAL server and a merchant server, and between the OPAL server and a bank server. The Internet provides the routing functionality between the client terminal and the various servers. A merchant advertises goods on a web site. A user uses the client terminal to purchase goods and / or services from the remote merchant server. The payment server processes, confirms and replies to the merchant server. The payment server is also used to authenticate the holder of a virtual card who wishes to redeem loyalty points from a merchant. To load value, the client terminal requests a load from a user account at the bank server. The load server processes, confirms and replies to the bank server.

Owner:VISA INT SERVICE ASSOC

Popular searches

Natural language data processing Substation equipment Office automation Point-of-sale network systems Location information based service Input/output processes for data processing Analogue secracy/subscription systems Color television details Internal/peripheral component protection Two-way working systems

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com