Patents

Literature

7720results about "Point-of-sale network systems" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

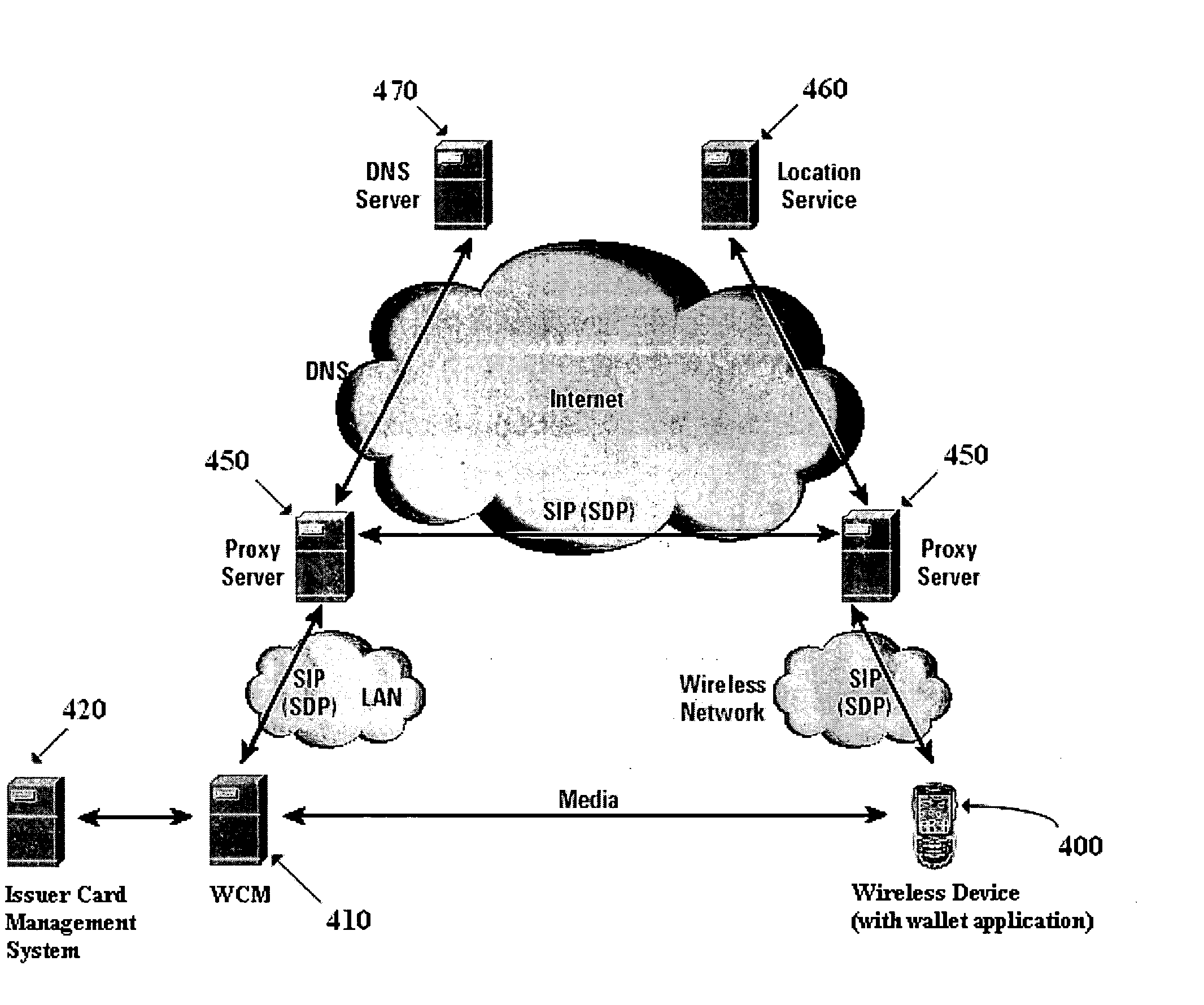

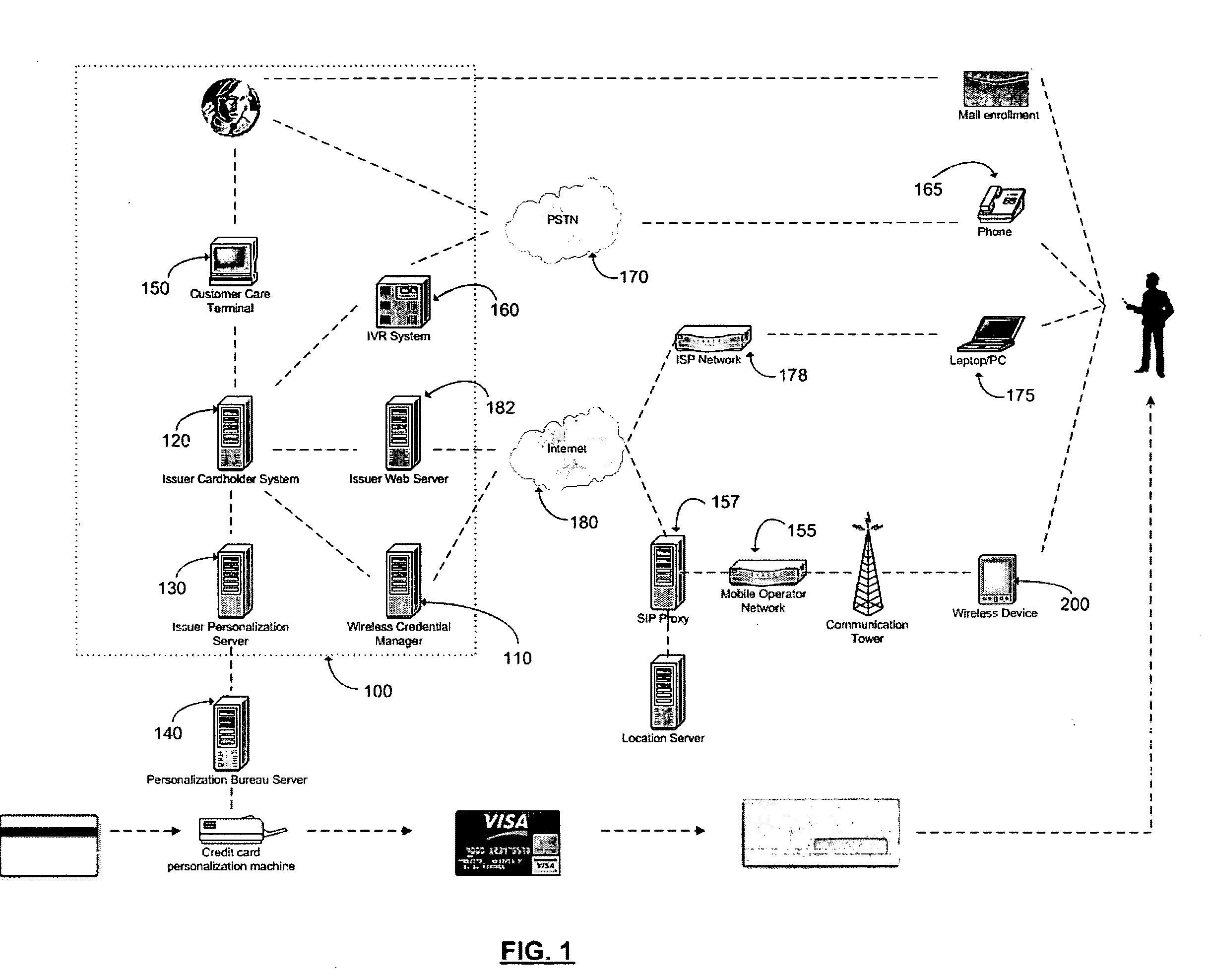

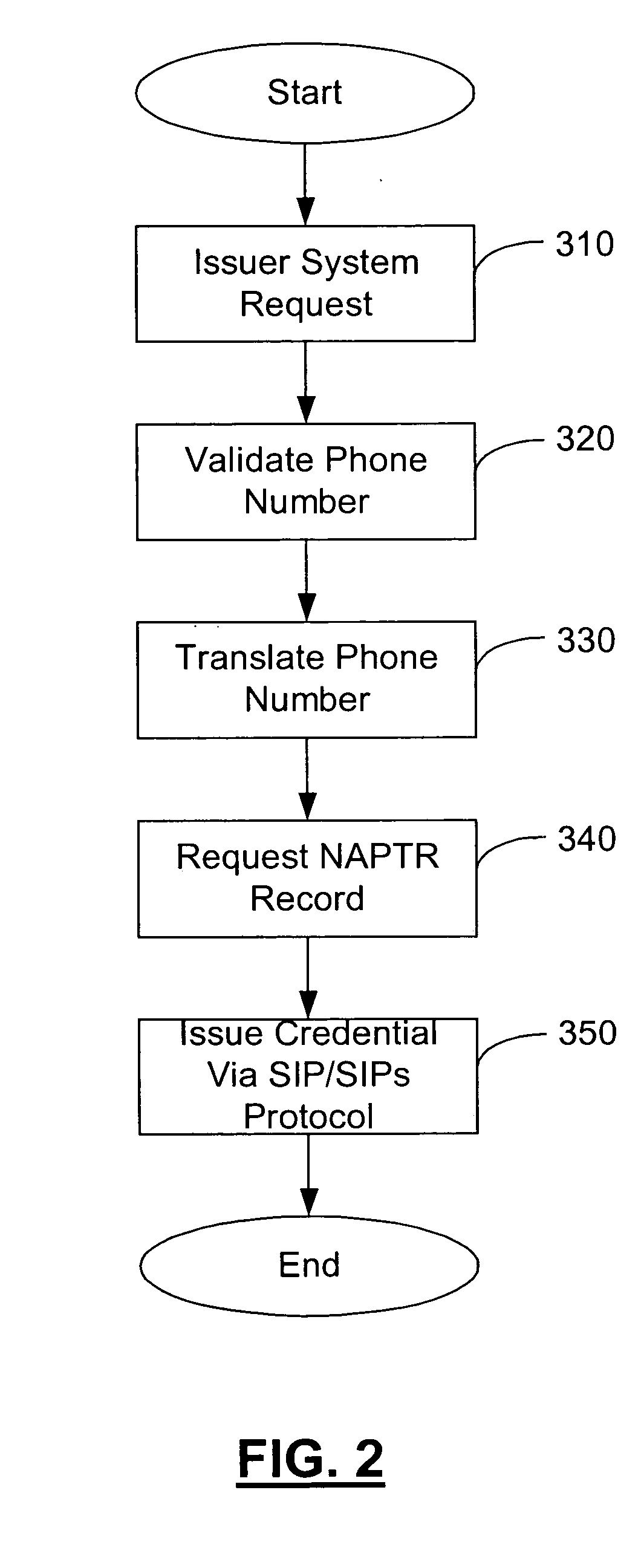

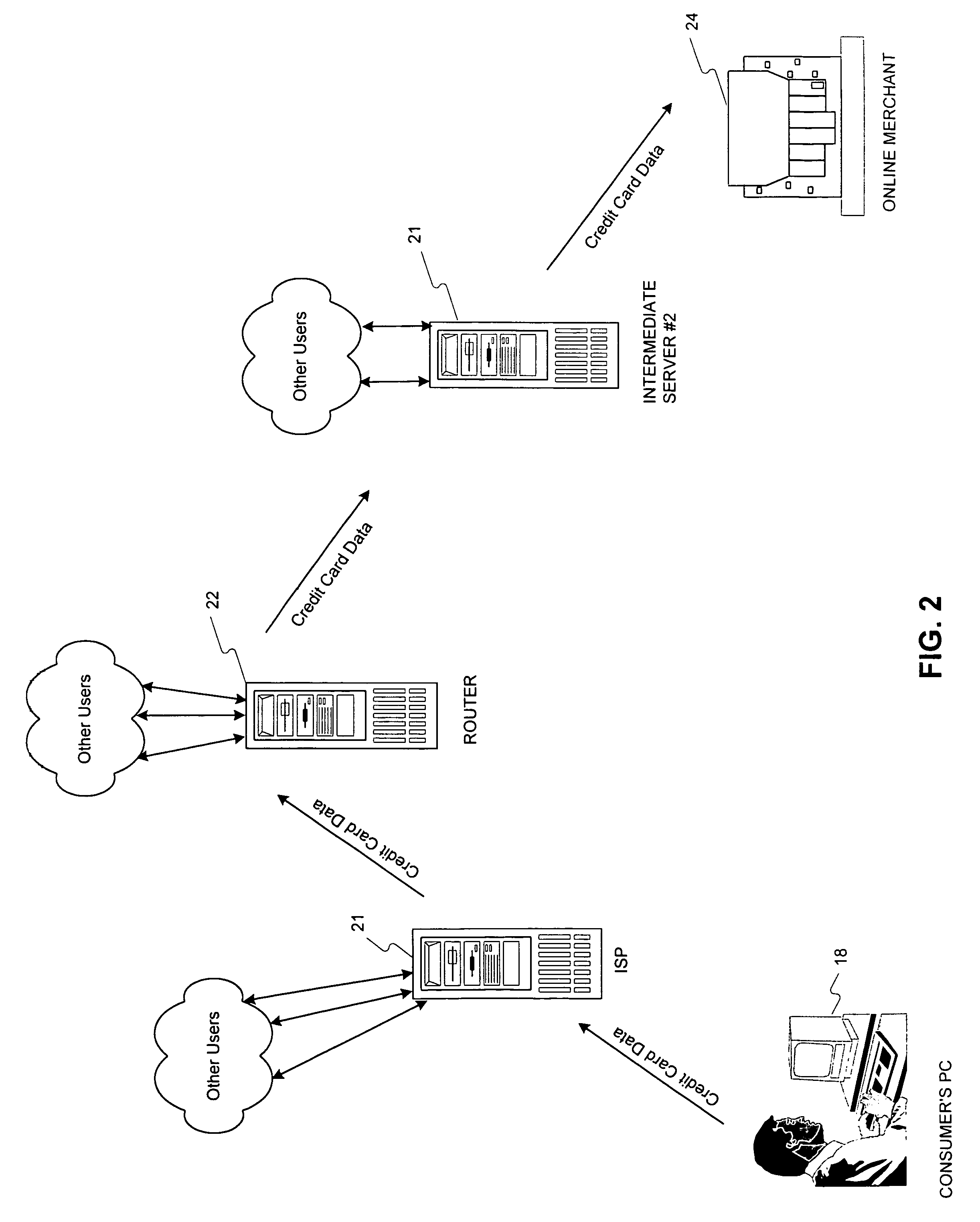

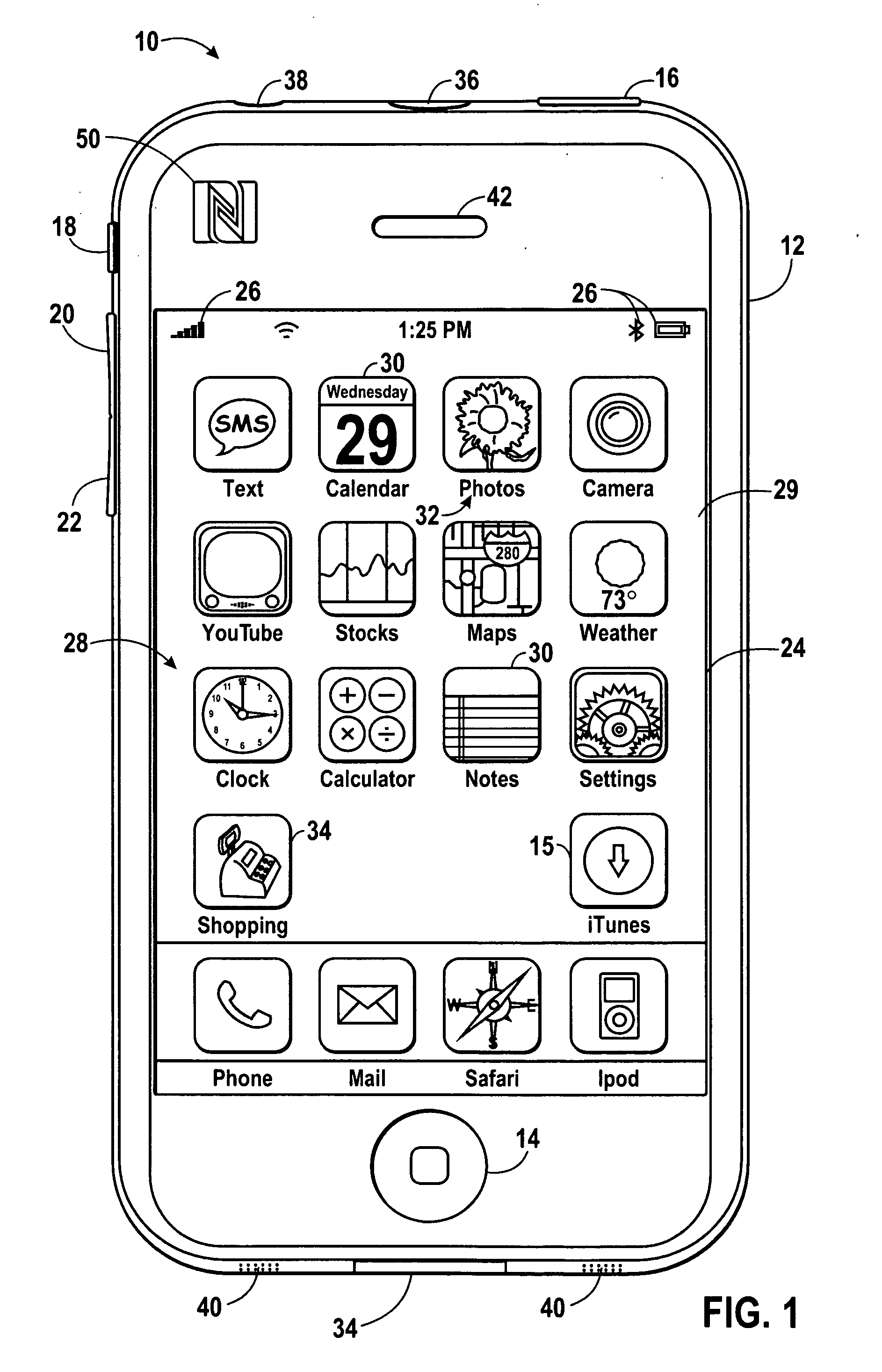

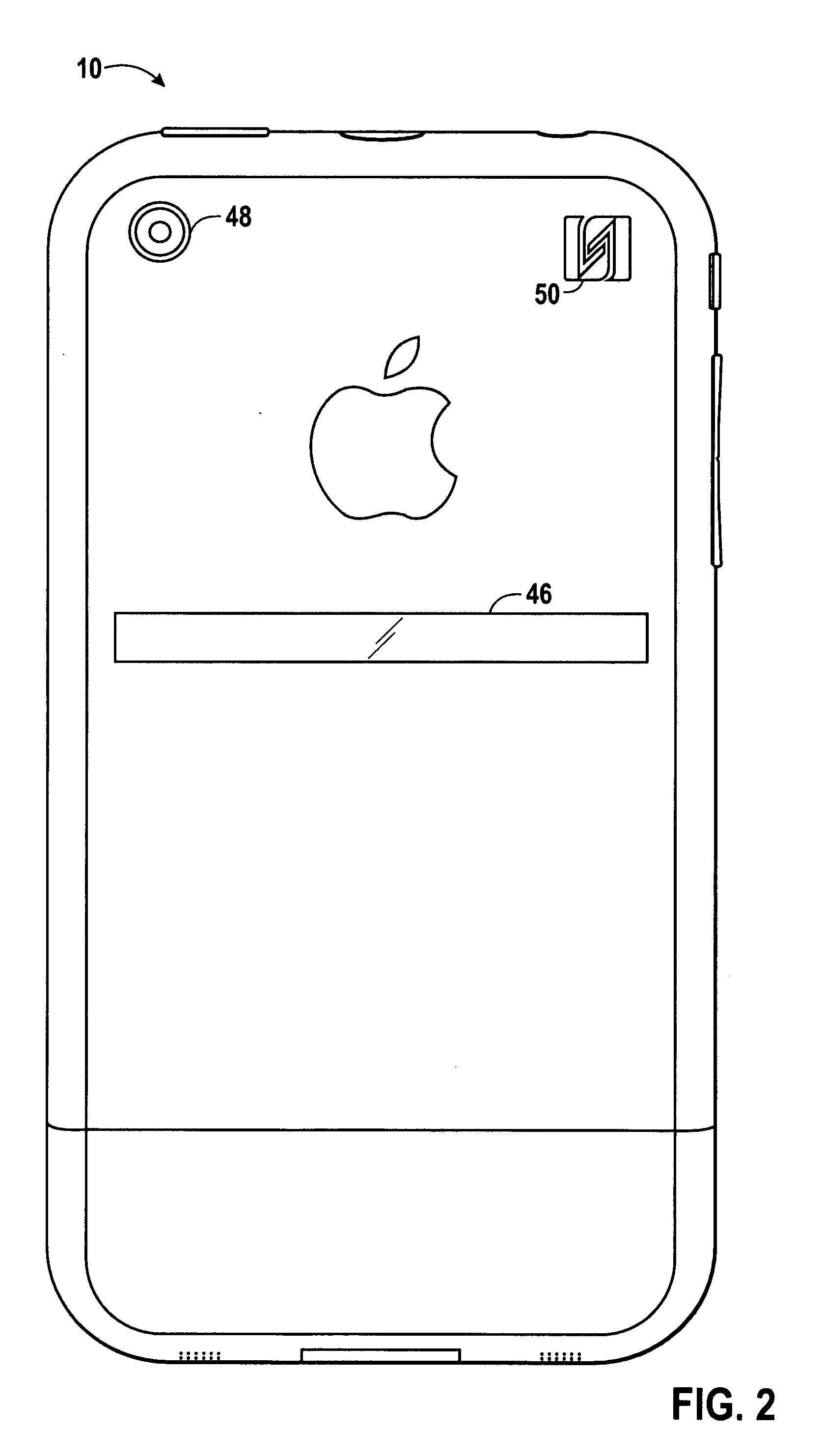

Method and apparatus for managing credentials through a wireless network

ActiveUS20060165060A1Convenient and efficient and secure distributionNear-field in RFIDData switching by path configurationCredit cardWireless mesh network

A novel system and methodology for conducting financial and other transactions using a wireless device. Credentials may be selectively issued by issuers such as credit card companies, banks, and merchants to consumers permitting the specific consumer to conduct a transaction according to the authorization given as reflected by the credential or set of credentials. The preferred mechanism for controlling and distributing credentials according to the present invention is through one or more publicly accessible networks such as the Internet wherein the system design and operating characteristics are in conformance with the standards and other specific requirements of the chosen network or set of networks. Credentials are ultimately supplied to a handheld device such as a mobile telephone via a wireless network. The user holding the credential may then use the handheld device to conduct the authorized transaction or set of transactions via, for example, a short range wireless link with a point-of-sale terminal.

Owner:SAMSUNG ELECTRONICS CO LTD

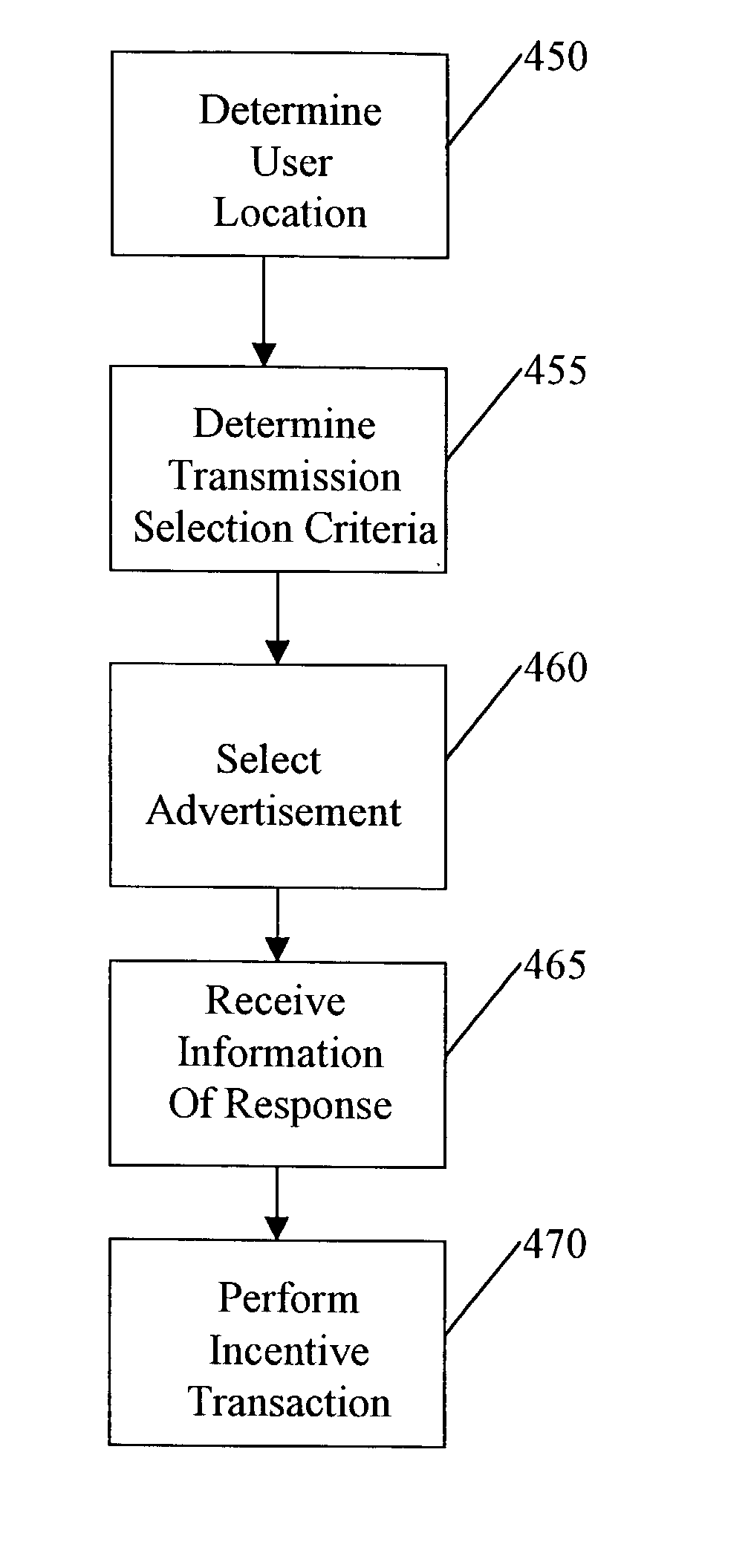

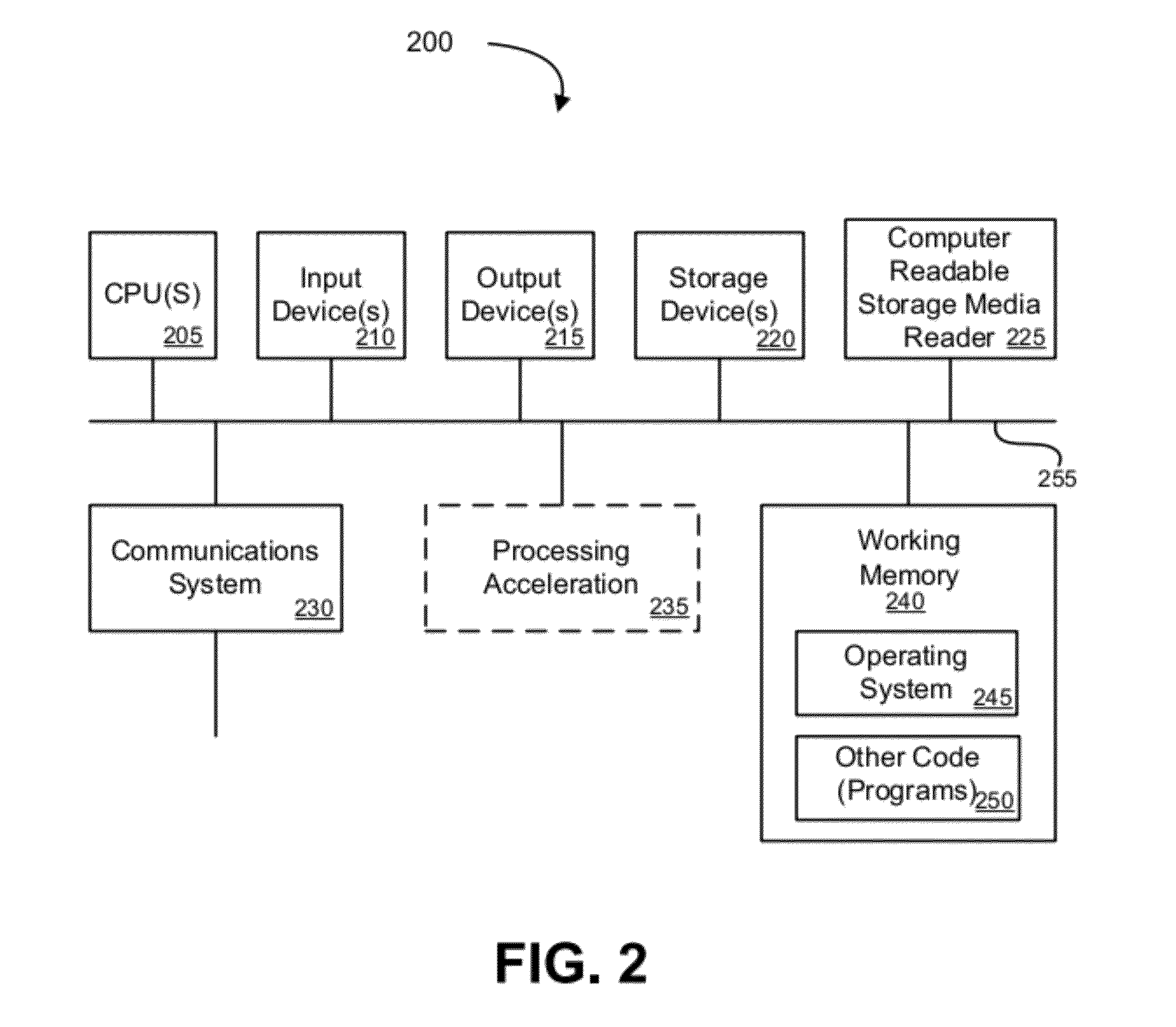

System, method, and computer program product for providing location based services and mobile e-commerce

ActiveUS20030220835A1Facilitating localized e-commerceFacilitate communicationAdvertisementsReservationsData fileDisplay device

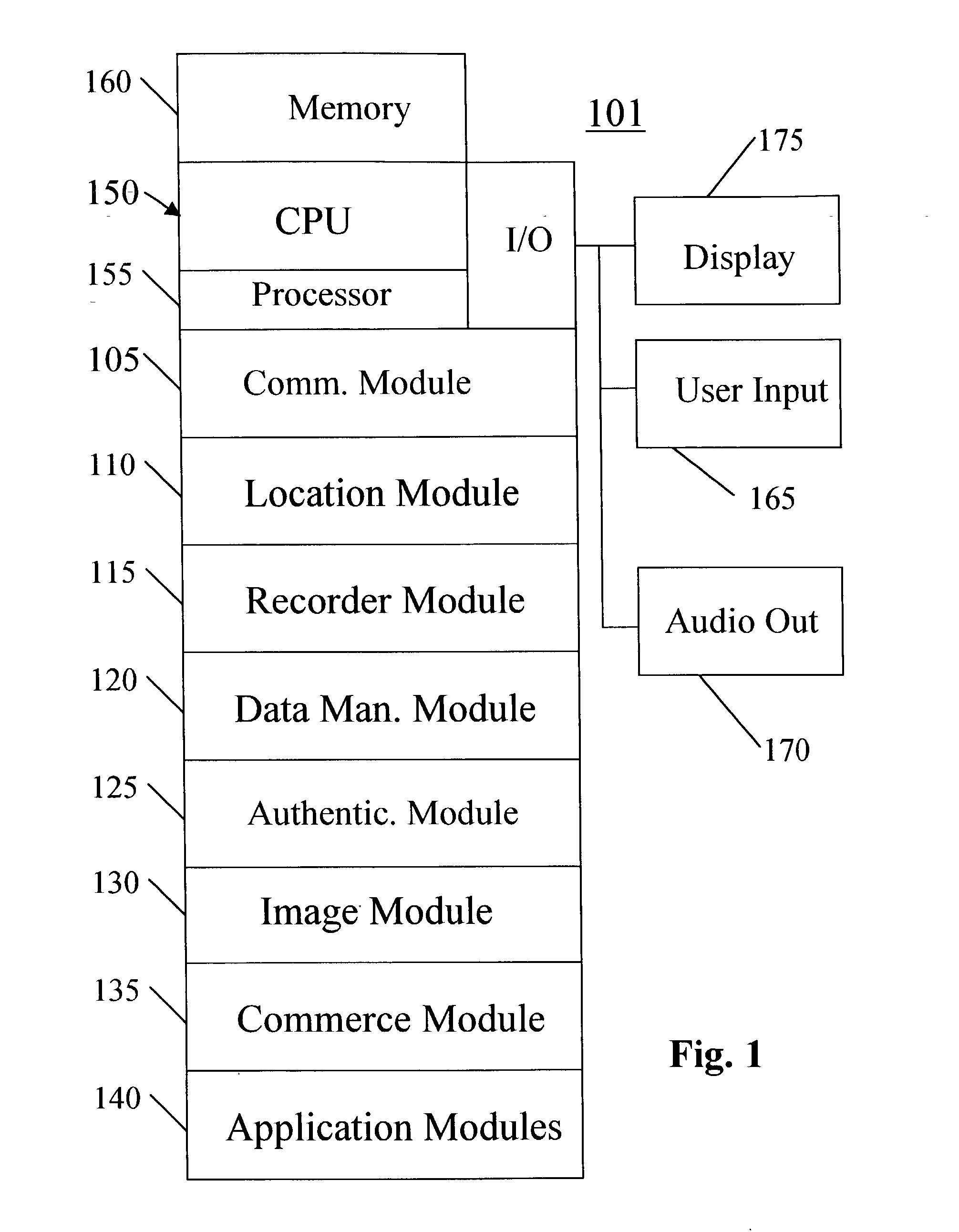

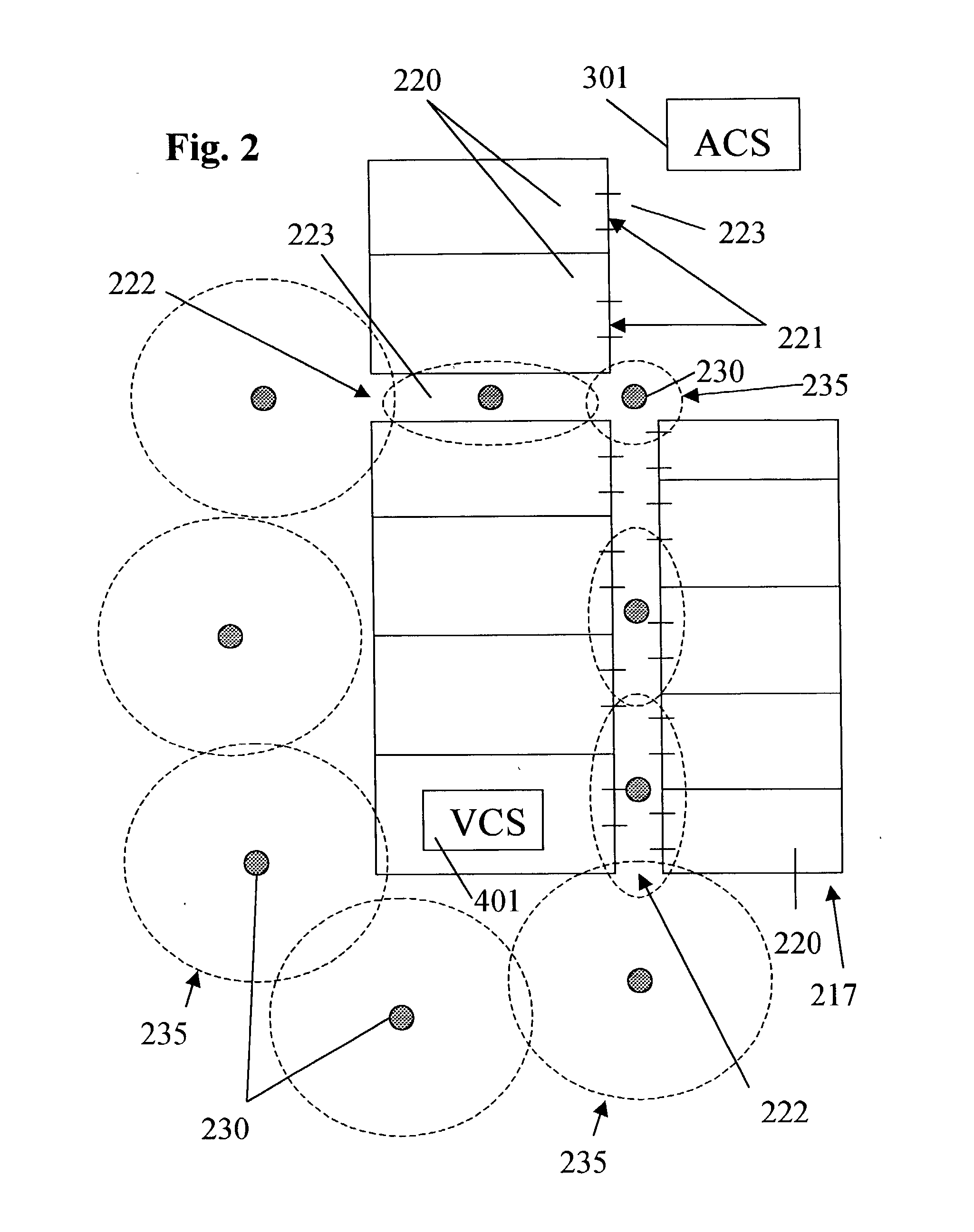

A system, method, apparatus and computer program product for providing location based functions and mobile e-commerce comprising a central processing unit including a processor, a storage device, and programming stored in the storage device, a display device, an audio input device, an audio output device, a communications module, a commerce module, an image module, and a location module. The programming controls the operation of the present invention to provide functions based on location data, to facilitate commercial exchanges by wirelessly exchanging payment and product information with venders, to identify services such as venders meeting selection criteria, to wirelessly exchange select information with other users and systems, to restrict and / or monitor the use of the device based on authorized user parameters, selecting one of a plurality networks through which to communicate, detecting a trigger for performing an action based on a change in location and sensed data, storing a voice annotation with a computer data file, determining service providers and associated communication parameters, contemporaneously maintaining a wireless voice and data link, providing a system for selecting and delivering mobile advertisements, and many other functions and services that are described herein.

Owner:GULA CONSULTING LLC

Portable communications device and method of use

A system, method, apparatus and computer program product for providing location based functions and mobile e-commerce comprising a central processing unit including a processor, a storage device, and programming stored in the storage device, a display device, an audio input device, an audio output device, a communications module, a commerce module, an image module, and a location module. The programming controls the operation of the present invention to provide functions based on location data, to facilitate commercial exchanges by wirelessly exchanging payment and product information with venders, to identify services such as venders meeting selection criteria, to wirelessly exchange select information with other users and systems, to restrict and / or monitor the use of the device based on authorized user parameters, to select one of a plurality networks through which to communicate, to detect a trigger for performing an action based on a change in location and sensed data, to store a voice annotation with a computer data file, to determine service providers and associated communication parameters, to contemporaneously maintain a wireless voice and data link, to provide a system for selecting mobile advertisements, and many other functions and services that are described herein.

Owner:WOUNDER

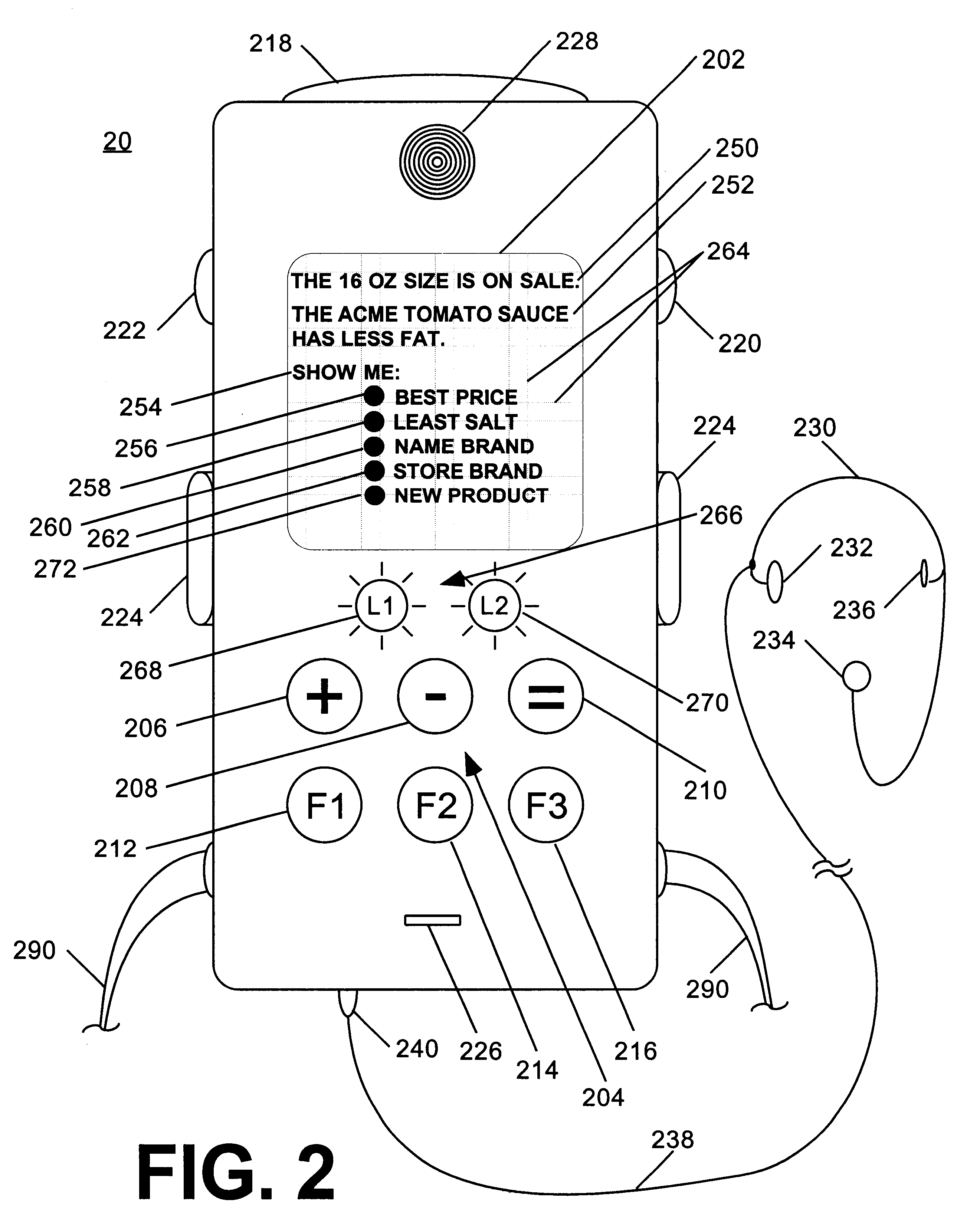

Consumer interactive shopping system

InactiveUS6837436B2Expand accessFunction increaseGuide needlesCredit registering devices actuationComputer terminalPortable data terminal

The present invention relates generally to a consumer interactive shopping and marketing system. The system includes a portable data terminal for communicating information over a communication network. The present system has aspects that may be used within a shopping establishment or at a user's home.

Owner:SYMBOL TECH LLC

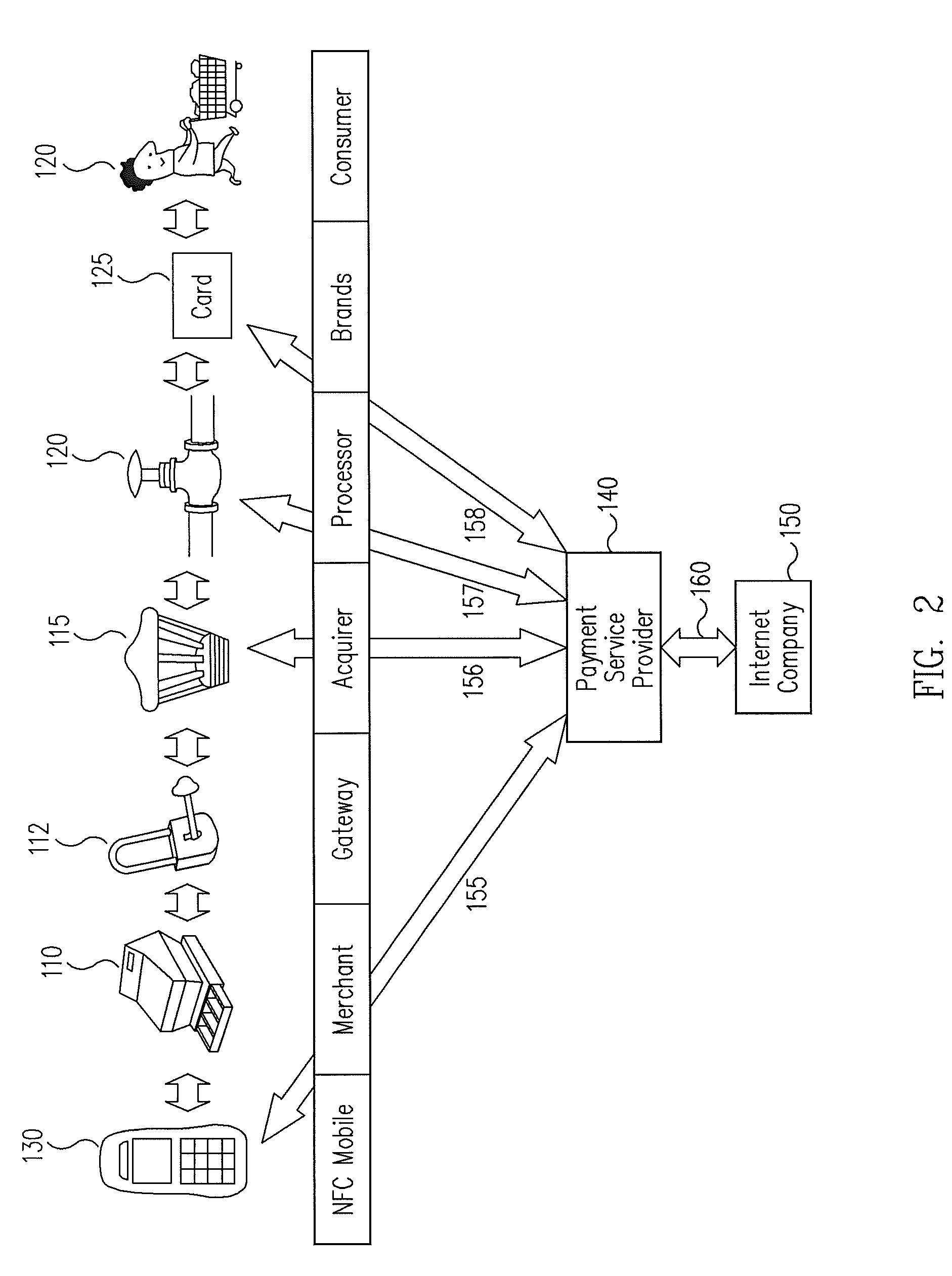

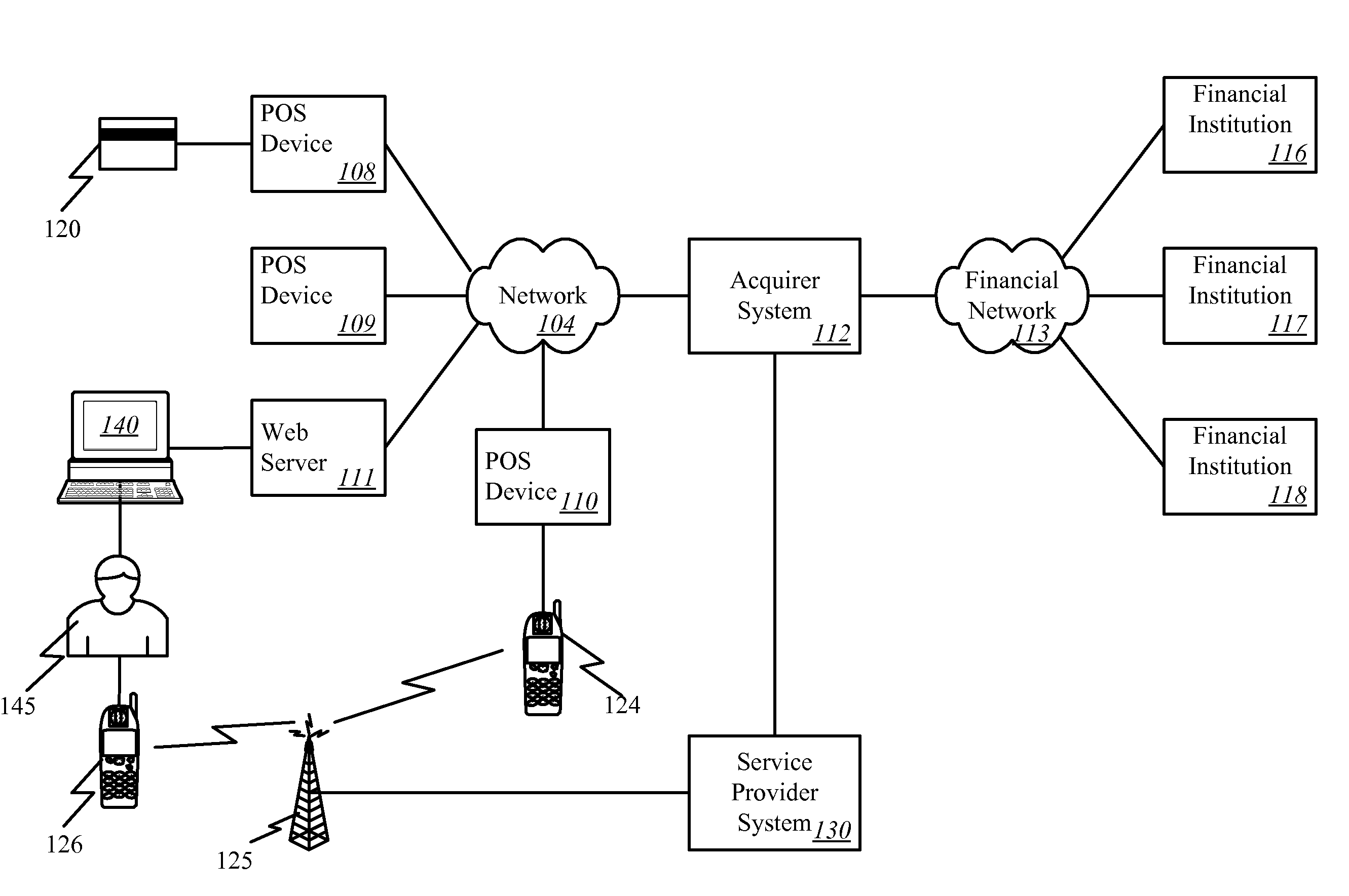

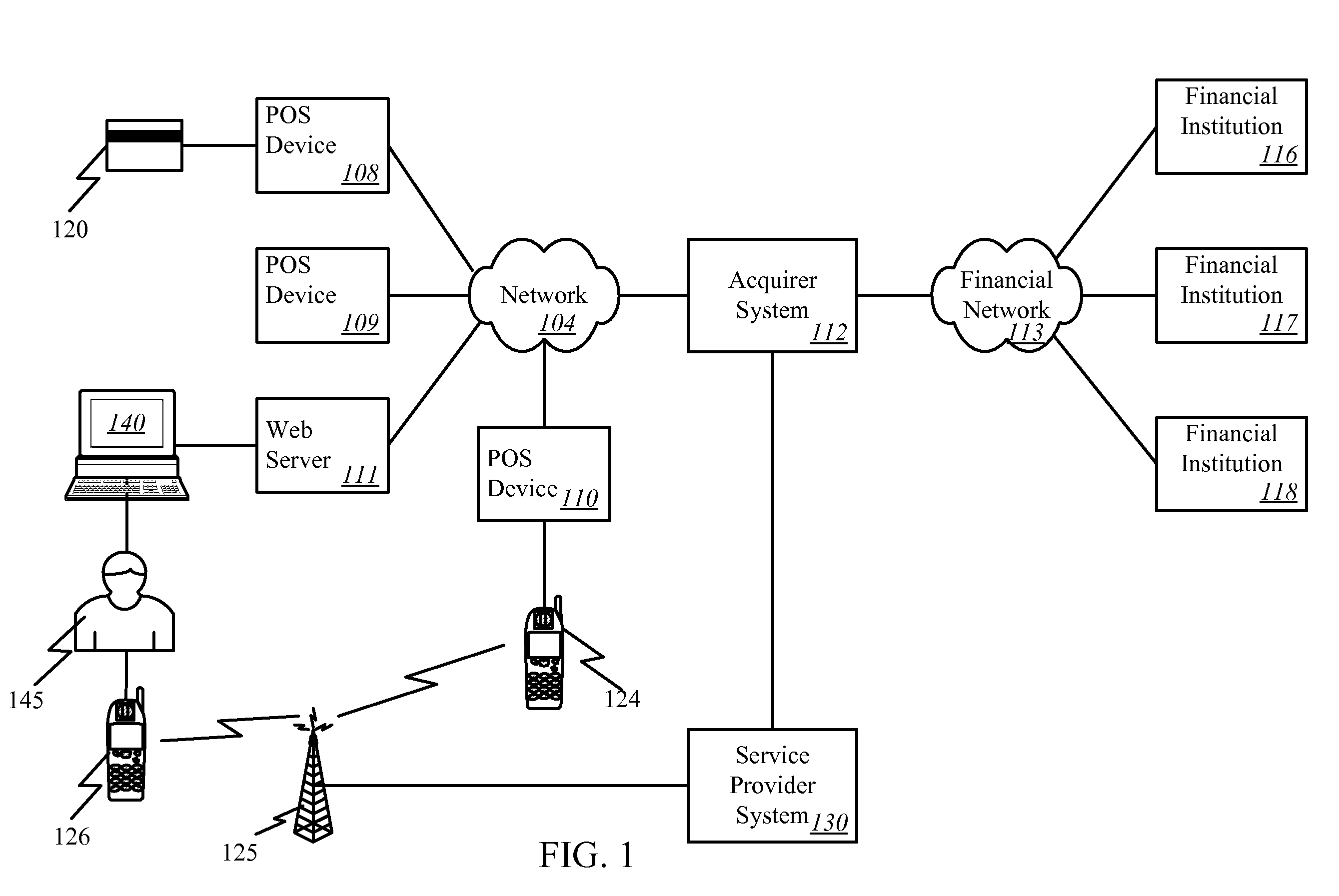

Payments using a mobile commerce device

InactiveUS20080208762A1Buying/selling/leasing transactionsPoint-of-sale network systemsPayment transactionAuthorization

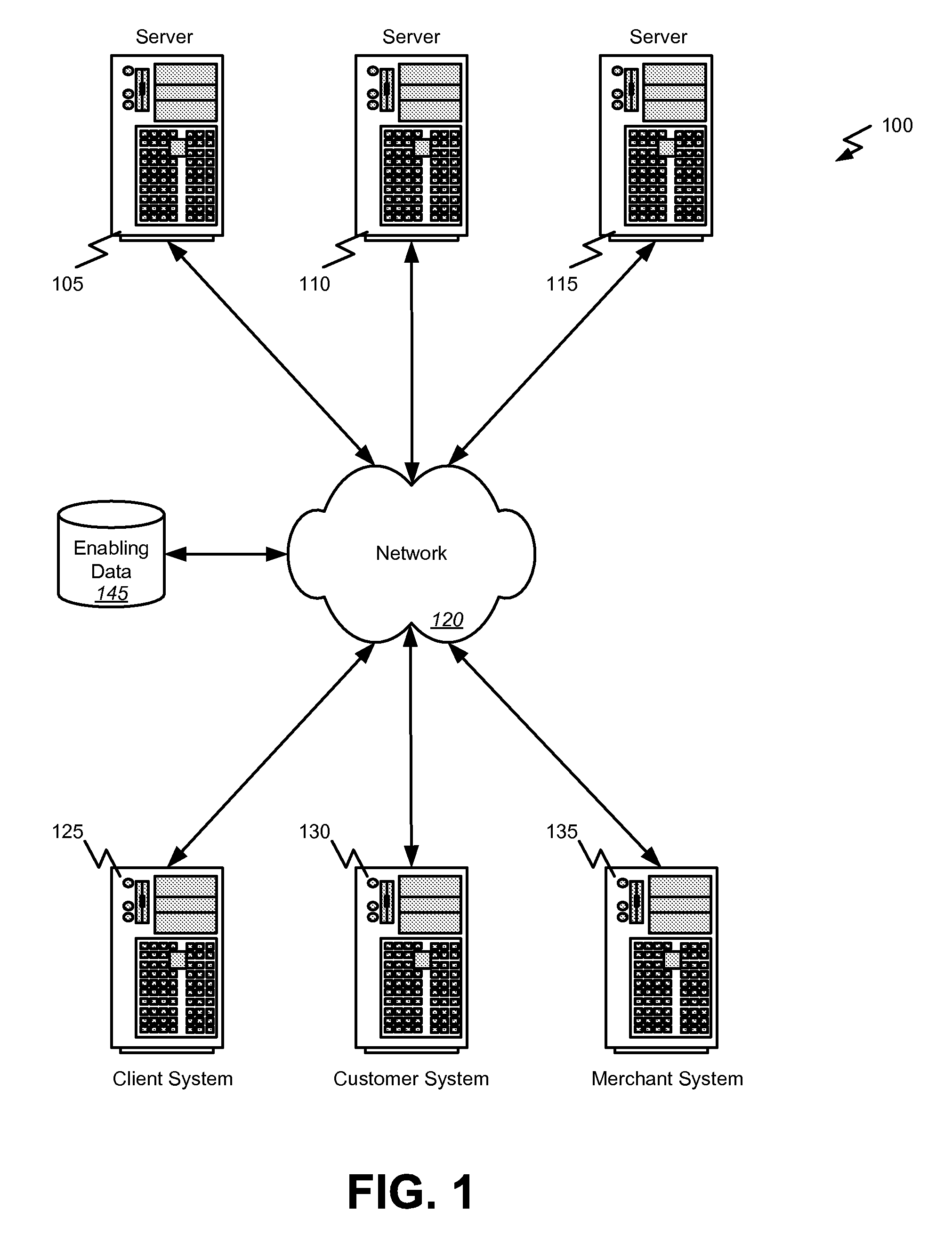

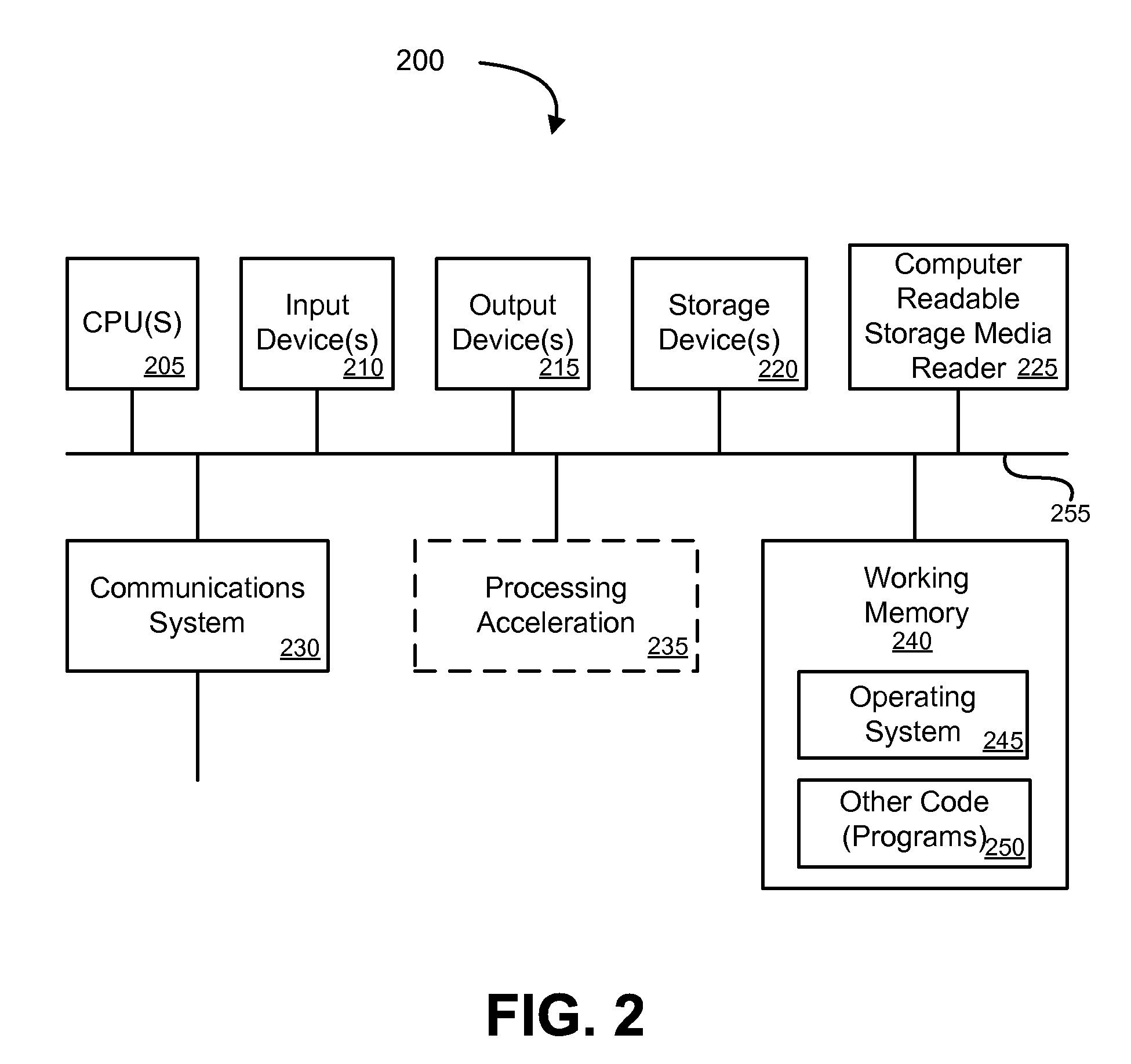

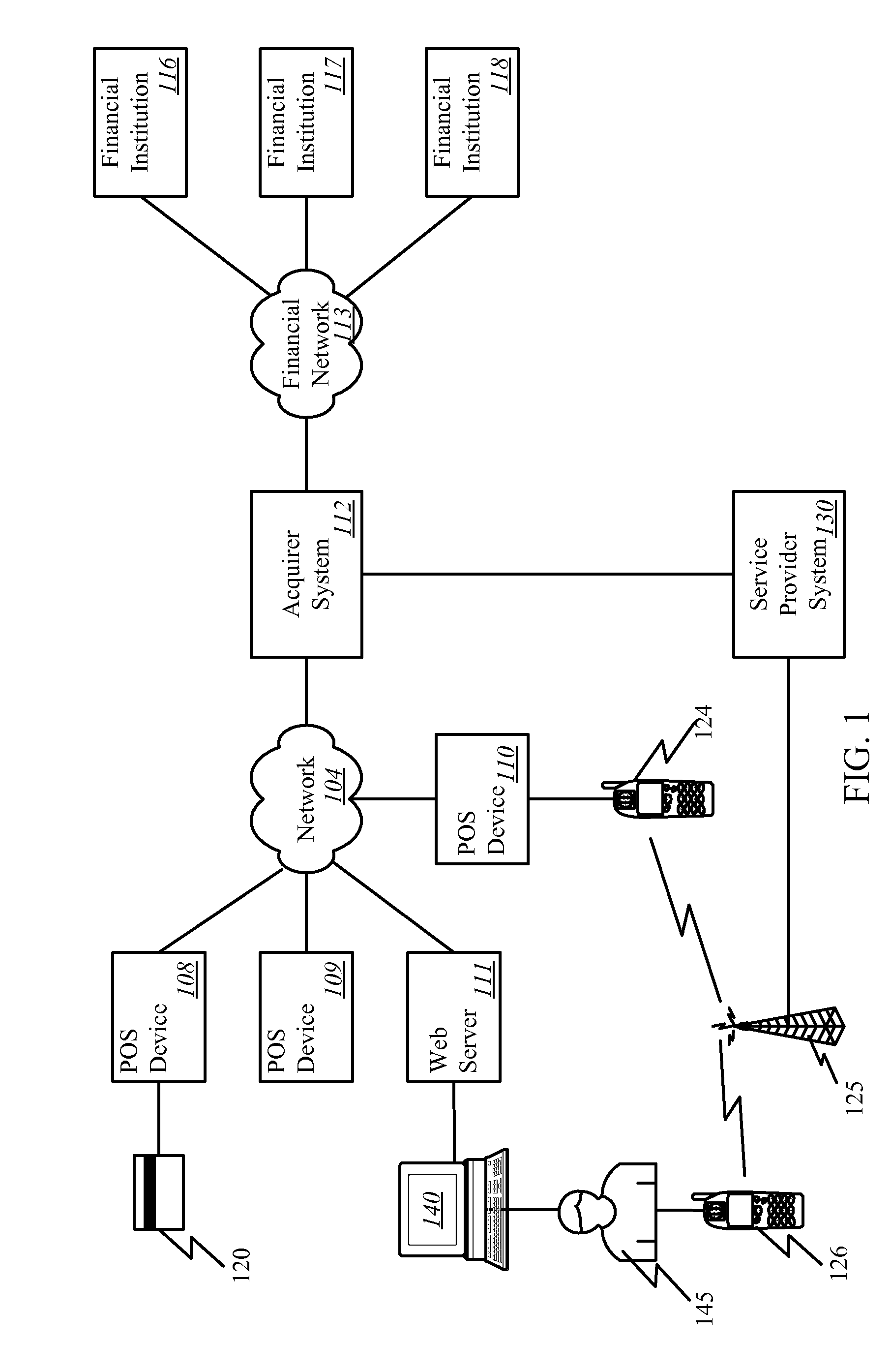

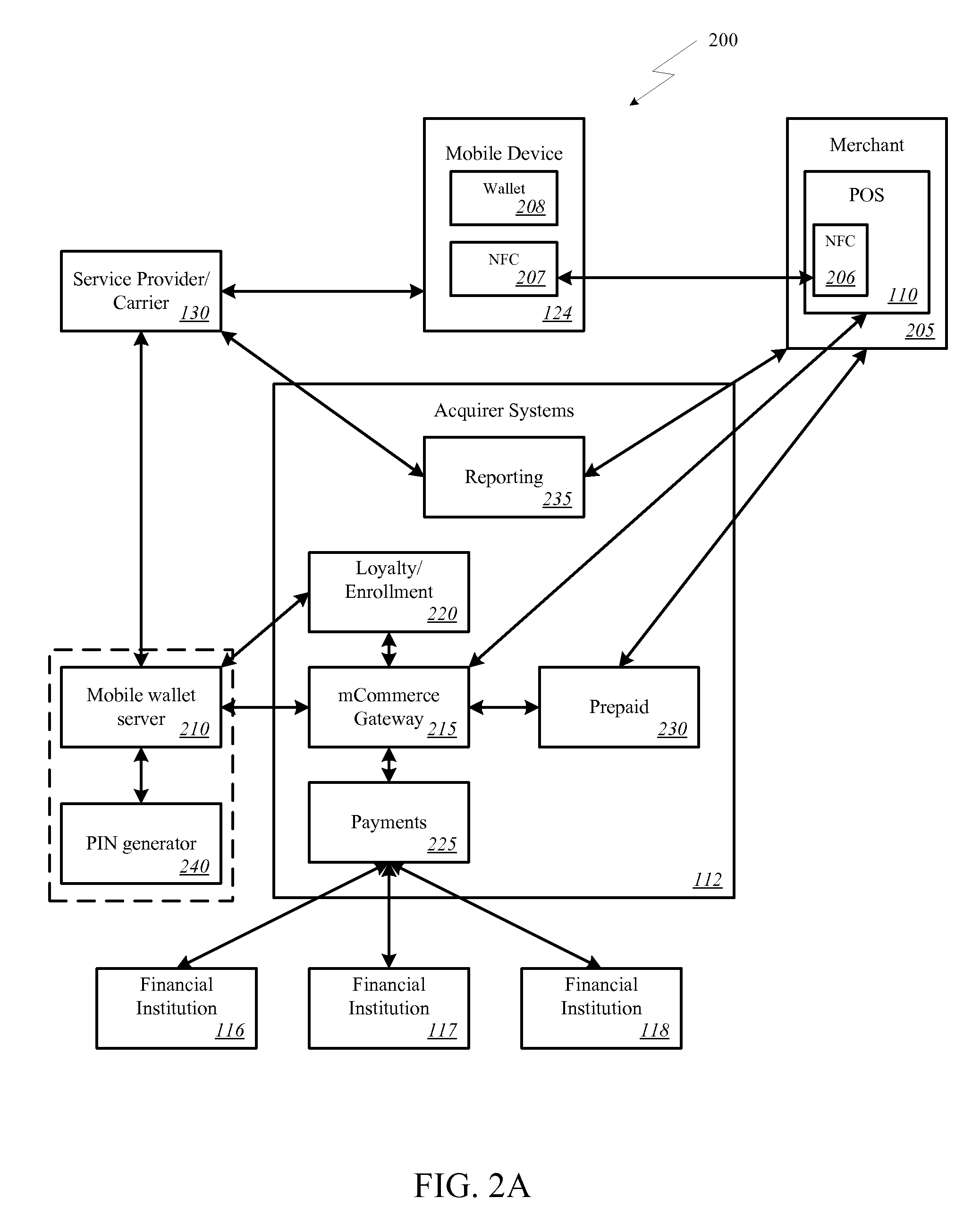

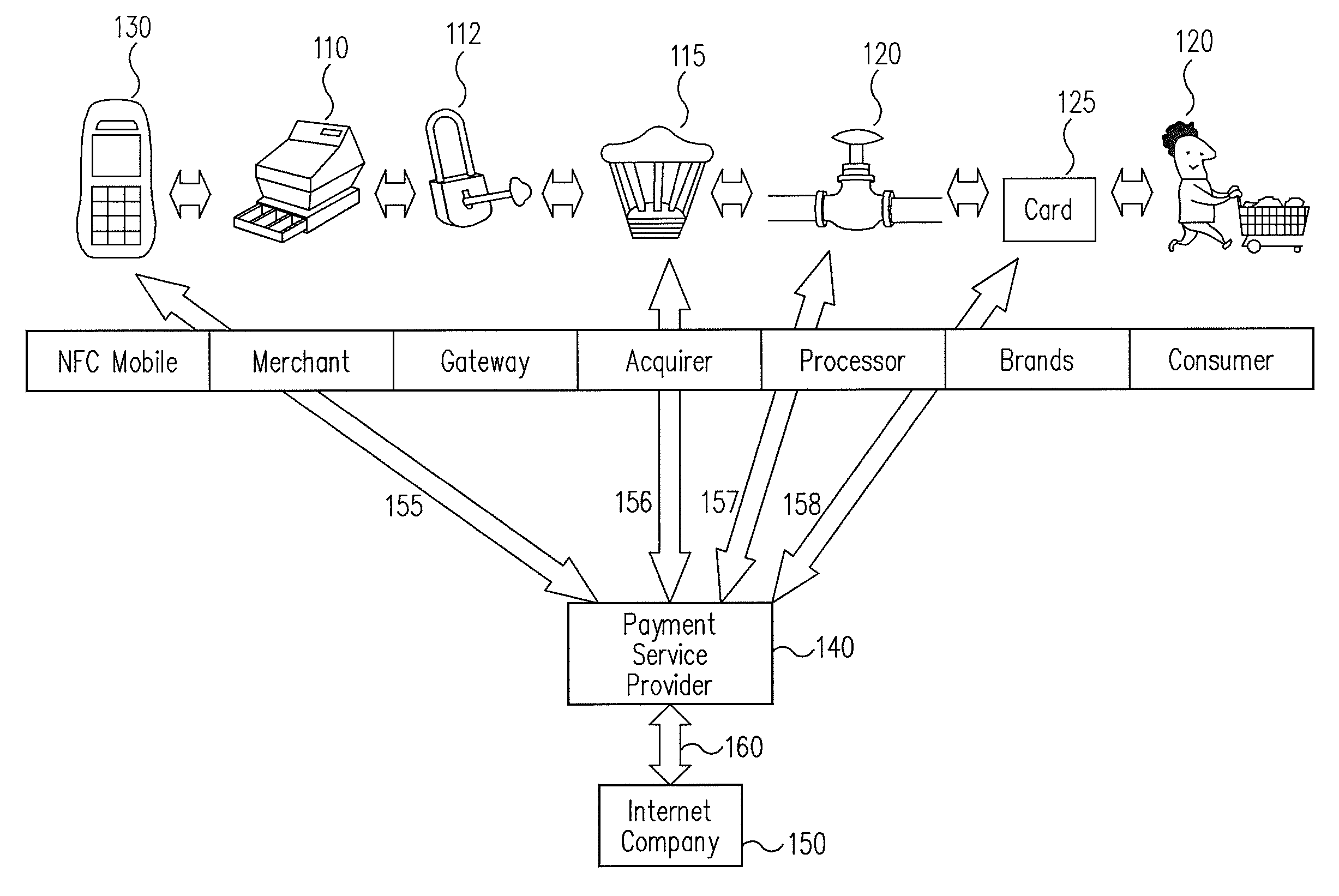

Methods, systems, and machine-readable media are disclosed for handling payment transactions in a mobile commerce system. According to one embodiment, a method of processing a payment transaction in a mobile commerce system can comprise receiving at a first acquirer system a communication from a point-of-sale (POS) device. The communication can be related to the payment transaction and can include information identifying a financial account from which a payment is requested. A second acquirer for authorizing the payment can be identified based on the information identifying the financial account. The communication can be sent to the second acquirer system for authorization of the transaction based on the information related to the financial account. An indication of whether the transaction is authorized can be received from the second acquirer system.

Owner:FIRST DATA

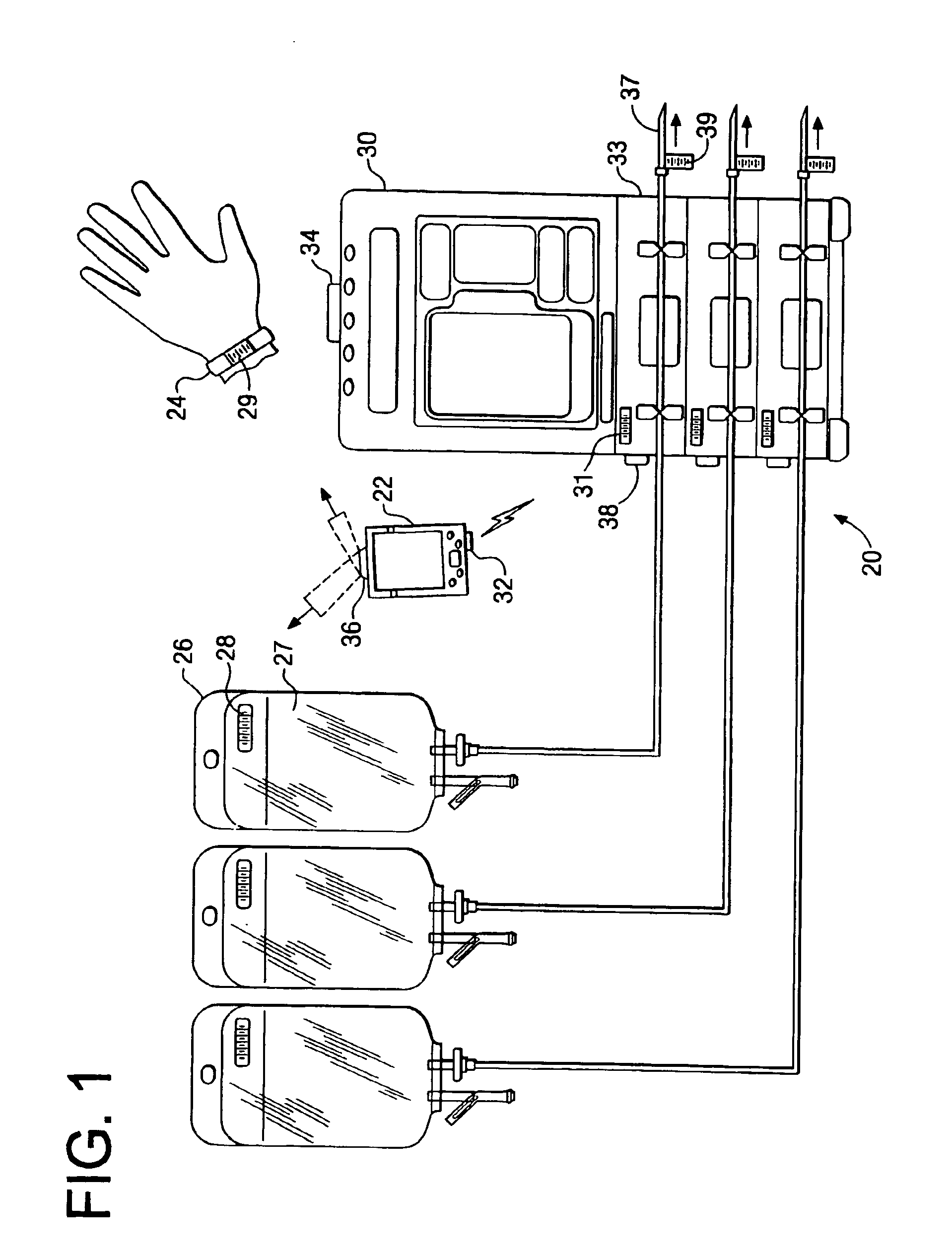

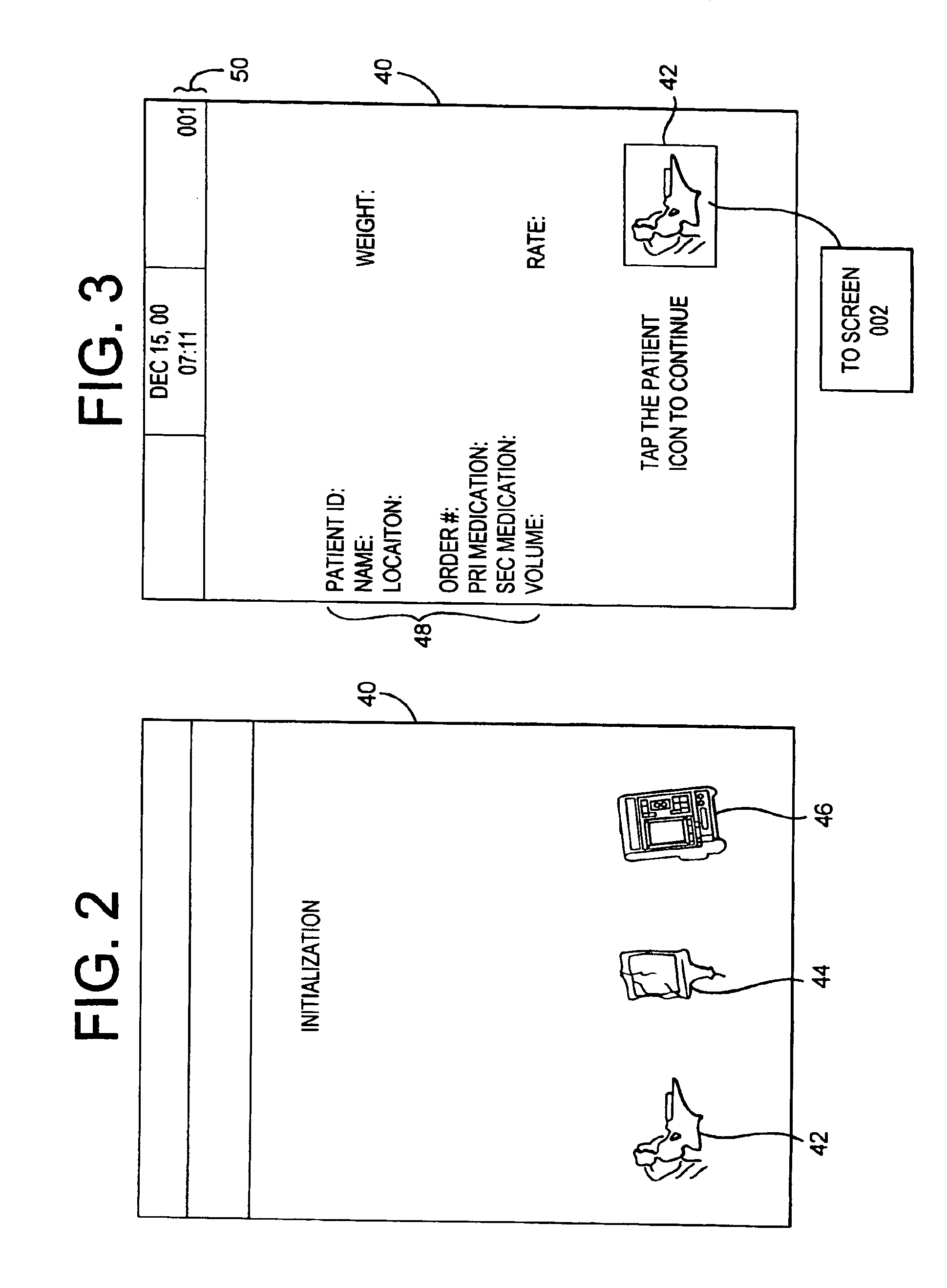

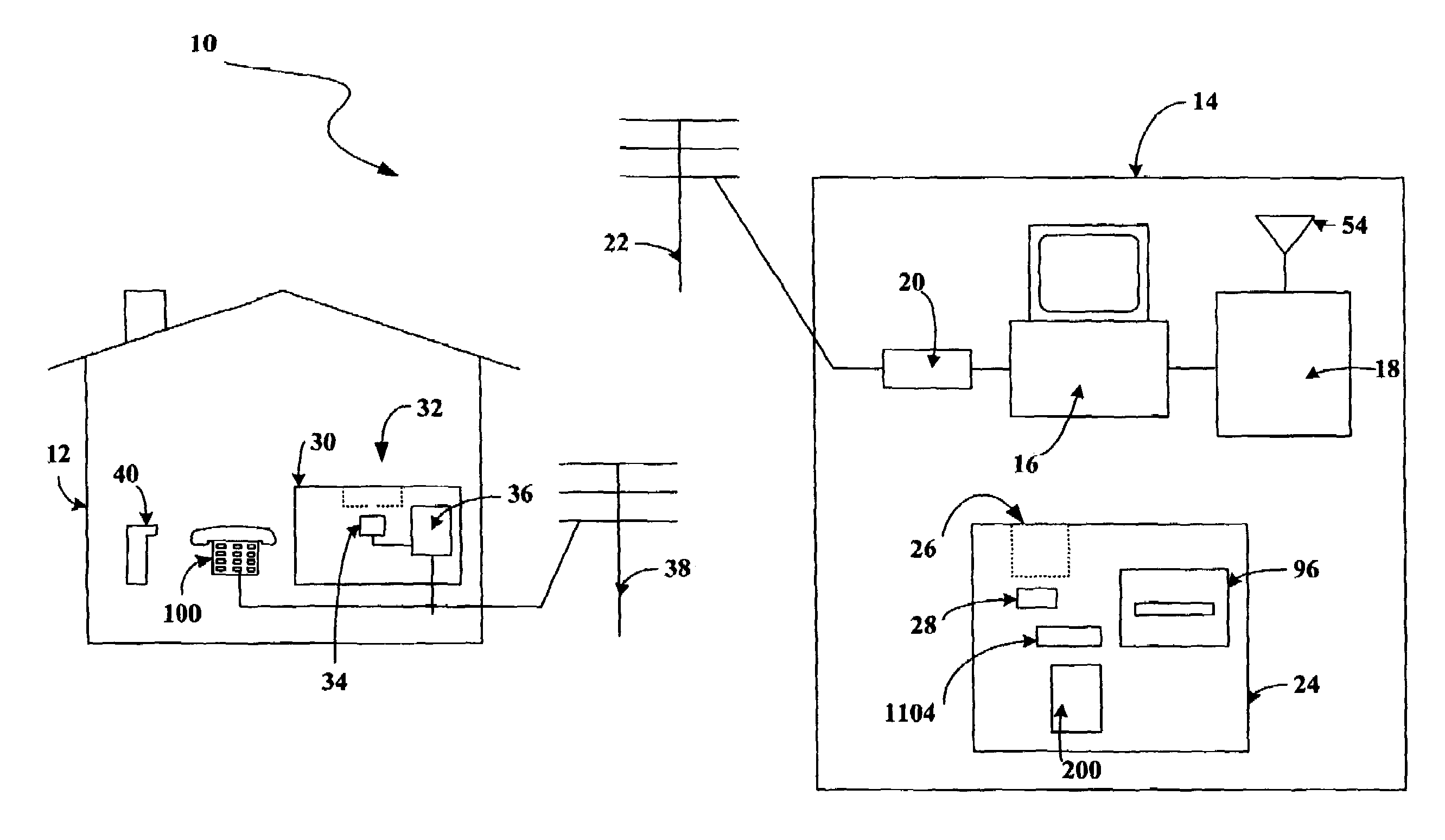

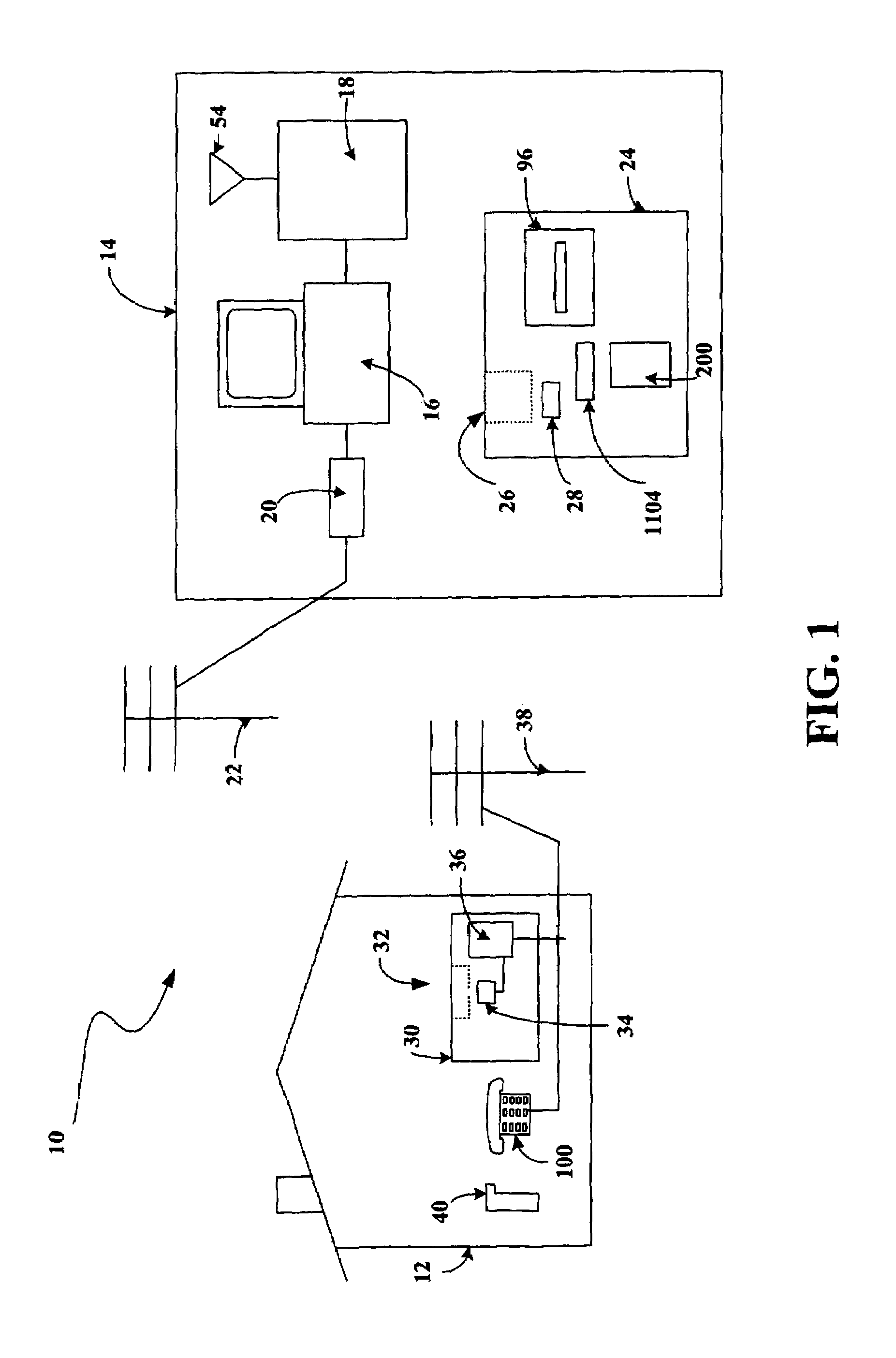

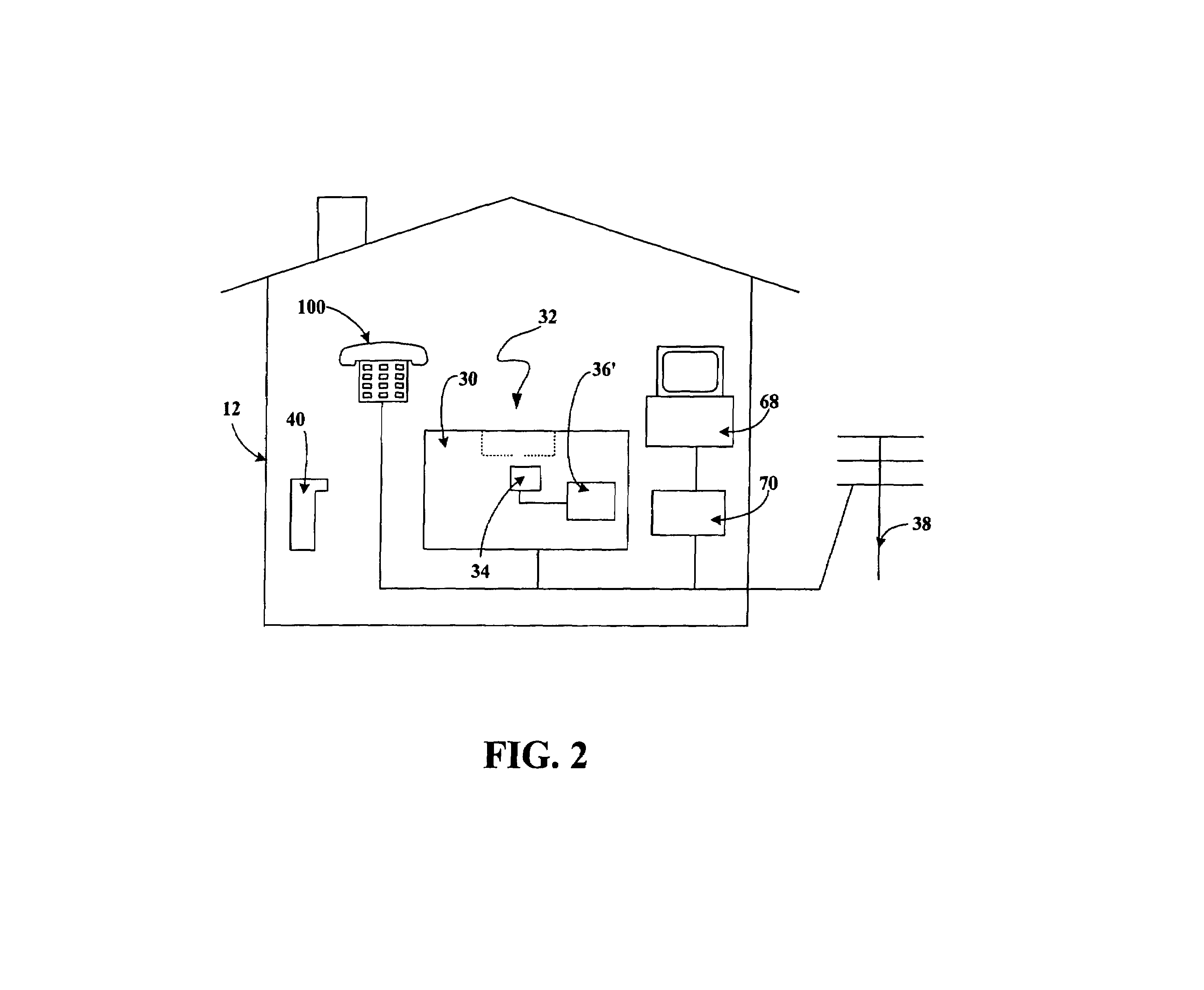

Medication delivery system

InactiveUS6985870B2Reduces potential medication errorDegrade some medicationHand manipulated computer devicesDrug and medicationsEmergency medicinePatient data

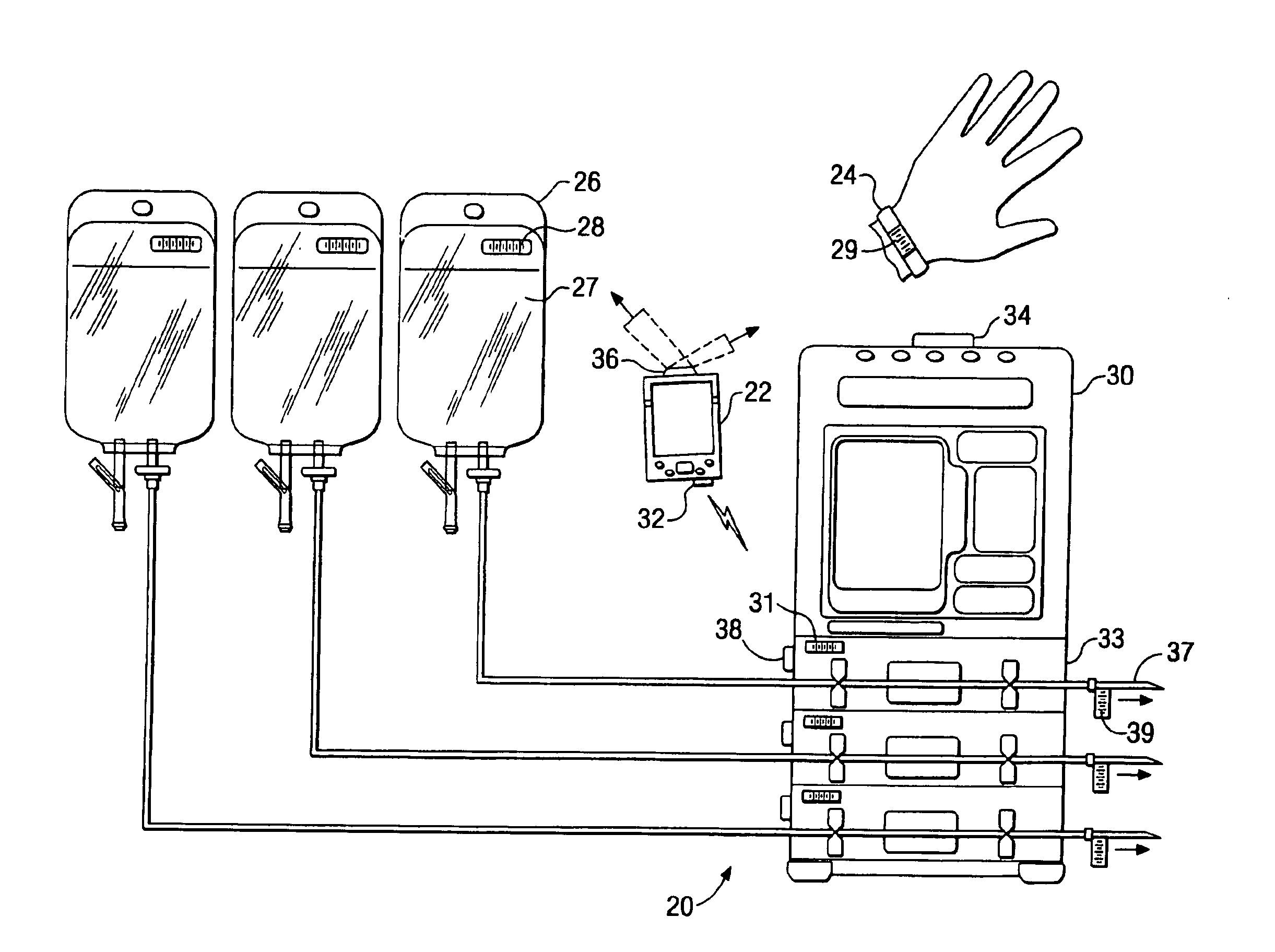

A medication delivery system (20) having features of the present invention comprises a medical container (26) holding a prescribed medication (27) to be delivered to a patient, a tag 24 adapted to be worn by the patient, a handheld computing device (22), and an electronic medication delivery device (30). Data on the medication (27) is contained in a first label (28) on the medication container (27). The first label (28) also contains the instruction on how the medication is delivered to the patient, including the appropriate settings for an electronic medication delivery device for delivering the medication to the patient. Patient data is contained in a second label (29) on the tag (24) worn by the patient. The medication data, medication delivery instruction, and patient data are provided in machine readable formats. The handheld computing device (22) reads the medication data and the medication delivery instruction on the medication container (26) and the patient data on the patient tag (24). The handheld computing device (22) stores the information obtained and performs a matching check to confirm that the medication data matches with the patient data. Upon a confirmed match, it transmits the medication delivery instruction to the electronic medication delivery device (30), which downloads the instruction, programs the delivery device 30, and prompts an operator to begin delivering the medication (27) to the patient according to the downloaded instruction.

Owner:BAXTER INT INC

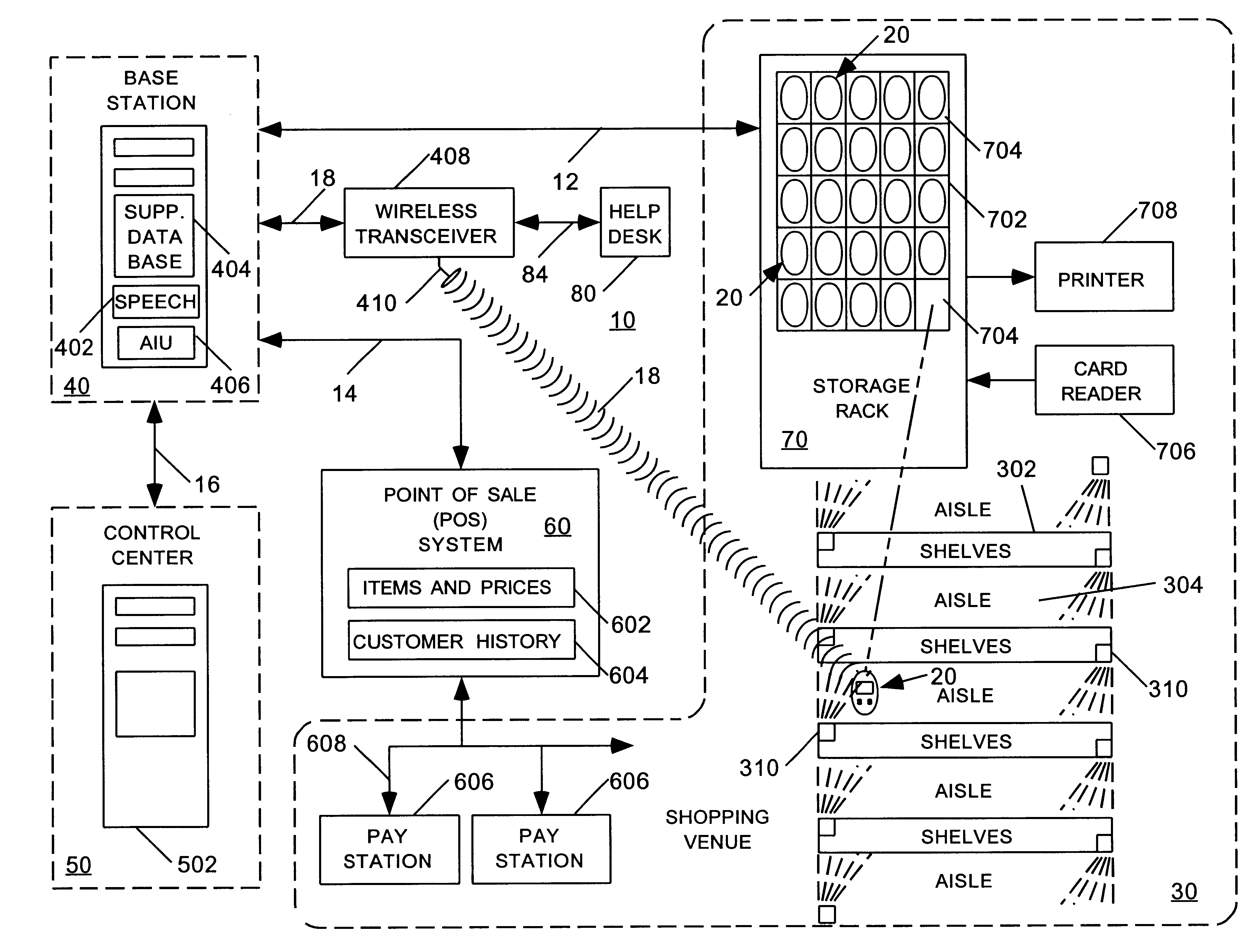

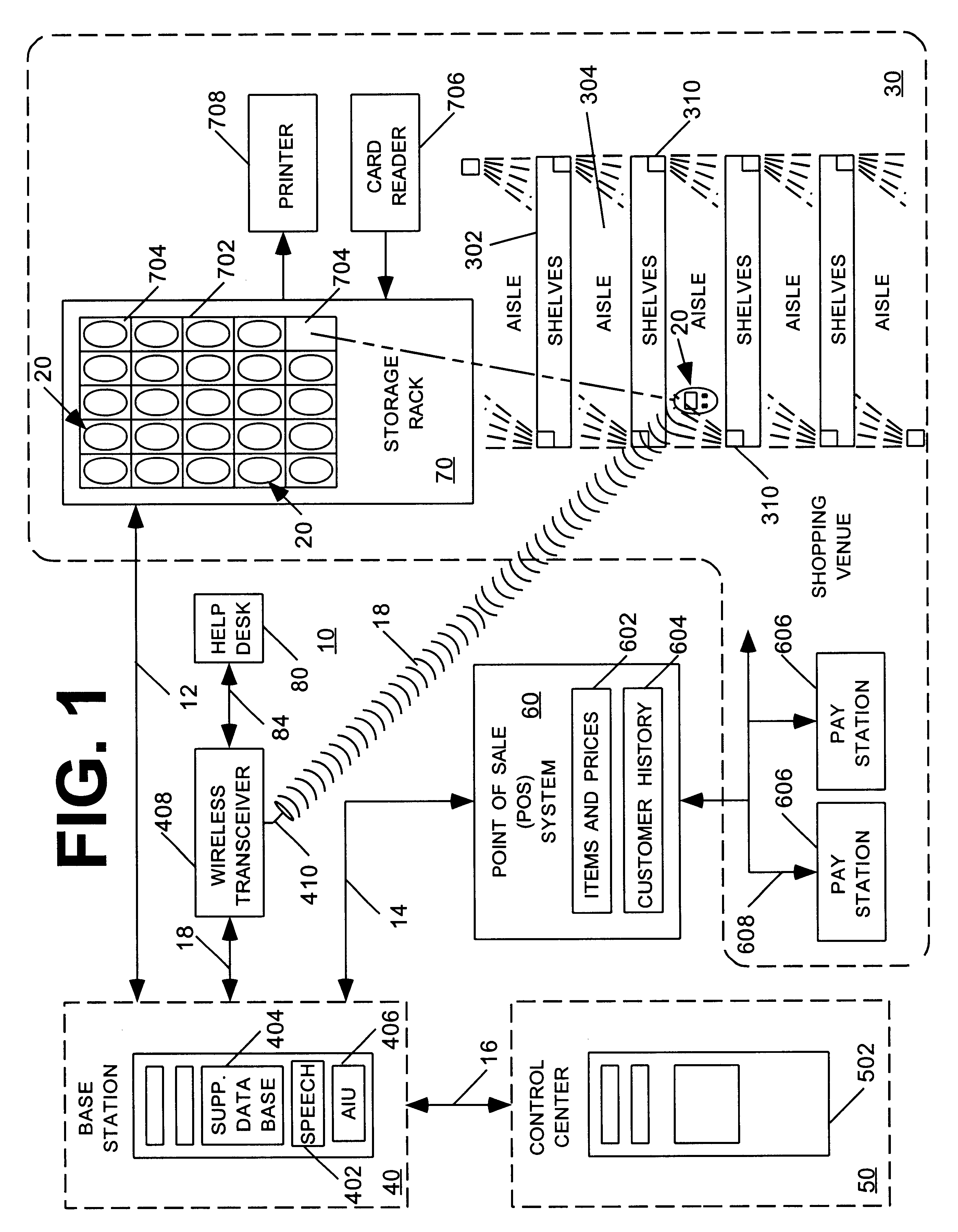

Interactive shopping system with mobile apparatus

An interactive system adapted for use in a shopping venue, comprises: an interactive and intelligent source of information, for example supplemental information related to articles available for selection by shoppers in a shopping venue, and not otherwise available to the shoppers during shopping; and, a plurality of interactive, mobile apparatus which shoppers can move throughout the shopping venue and use for transmitting queries to the interactive source of information and use for receiving information transmitted from the interactive source of information, whereby shoppers can receive information useful for evaluating the articles when making article selection decisions, and at least some of the received information can be formulated to influence the article selection decisions. At least some of the information transmitted to the shoppers can be responsive to the queries. An artificial intelligence unit can evaluate the queries and select information for inclusion in responses to the queries.

Owner:TAMIRAS PER PTE LTD LLC

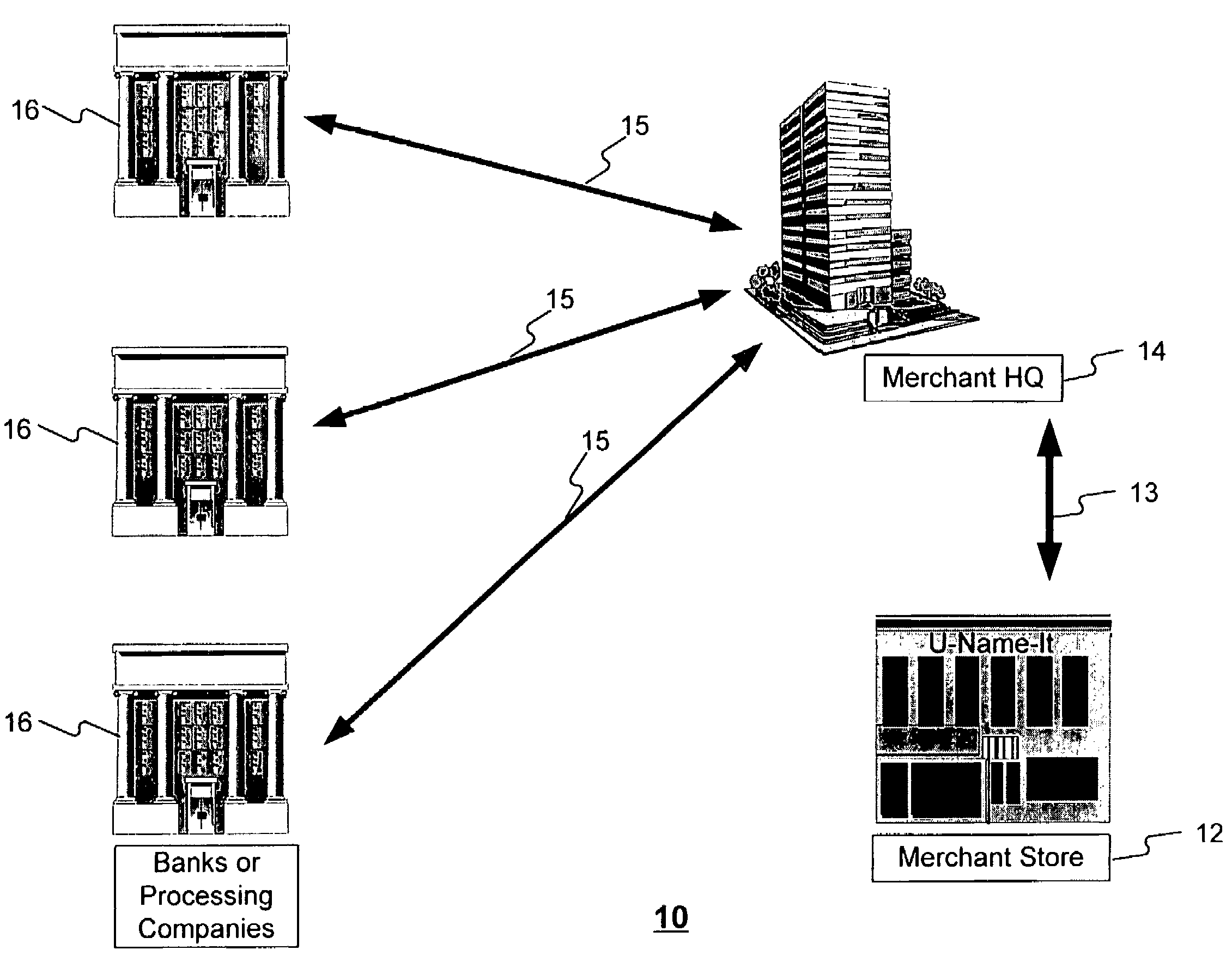

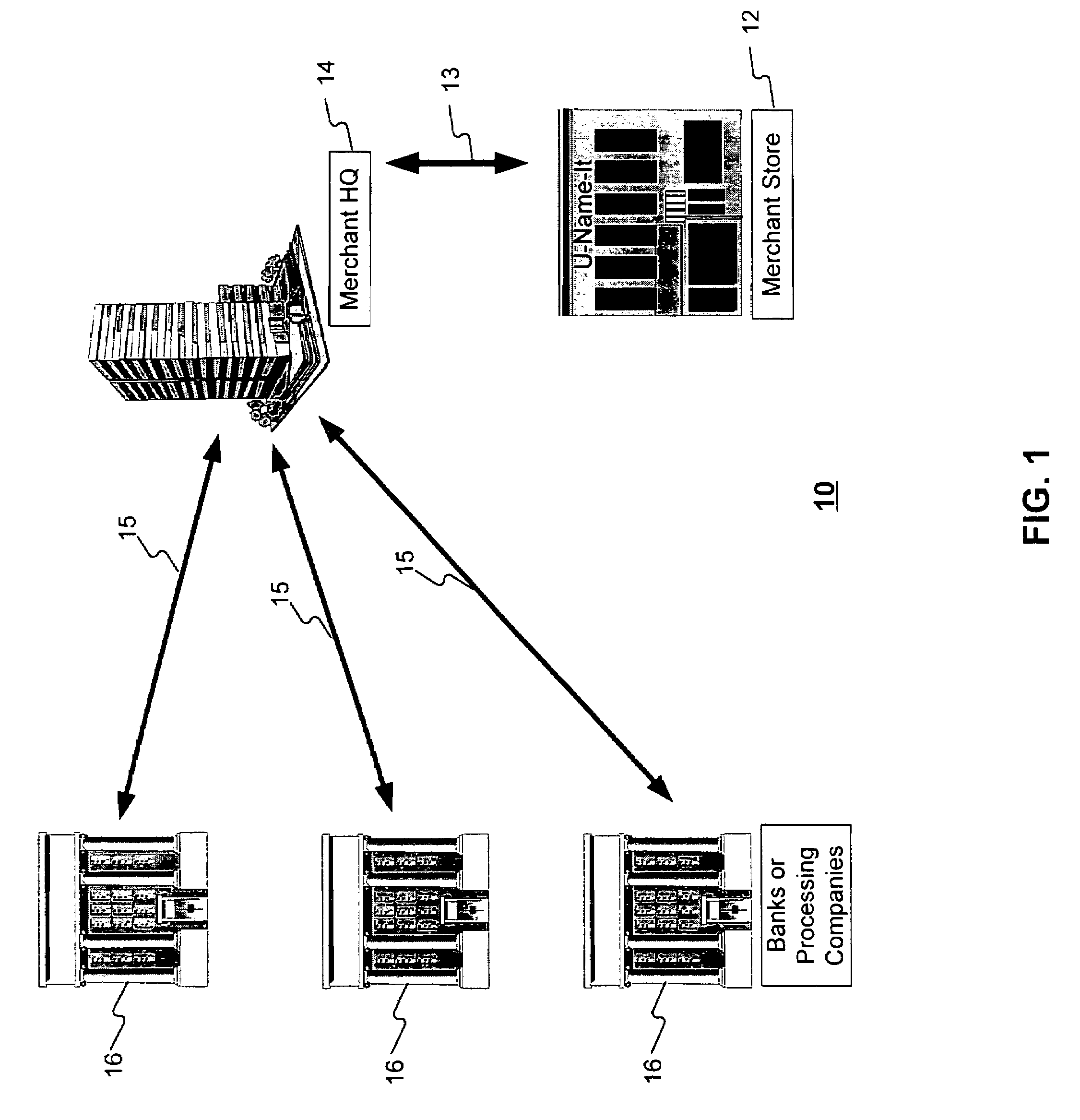

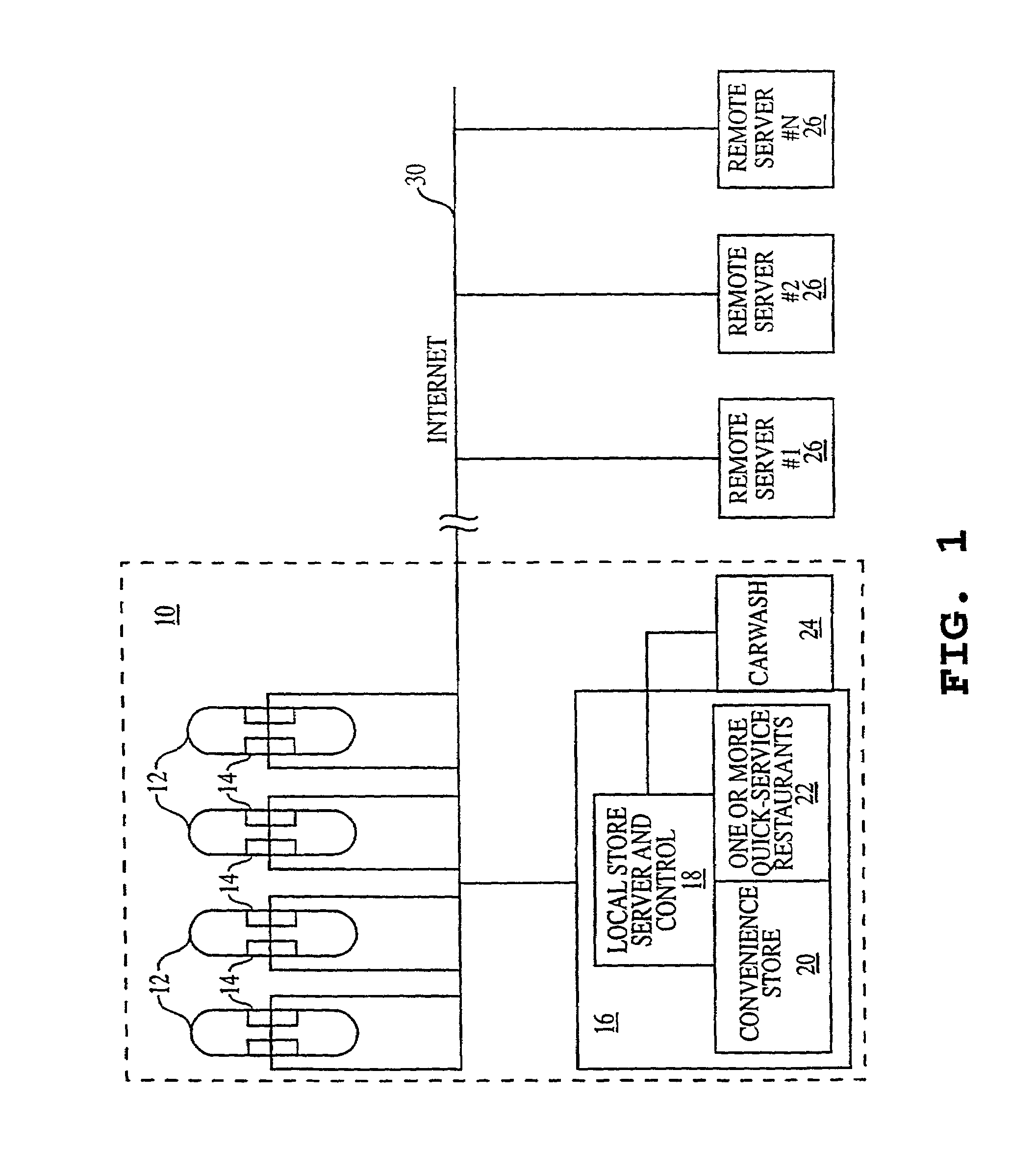

System and method for processing financial transactions

InactiveUS7571139B1Improve securityGreat degree of convenienceFinanceCash registersPaymentFinancial transaction

A network for processing retail sales transactions includes a customer transceiver with a unique customer number, a reader receiving the customer number and sending it to a point-of-sale device where it is combined with transaction information to form a transaction entry. The transaction entry is sent through a merchant computer to a transaction processing system having a customer database. The transaction processing system references an entry in the customer database corresponding to the customer / transmitter ID number and routes the transaction entry to a payment processing system specified in the customer database entry.

Owner:EXXON RES & ENG CO +1

Transaction apparatus and method

InactiveUS6315195B1Low production costEasy to operateHybrid readersPoint-of-sale network systemsComputer hardwareBarcode

Owner:DIEBOLD SELF SERVICE SYST DIV OF DIEBOLD NIXDORF INC

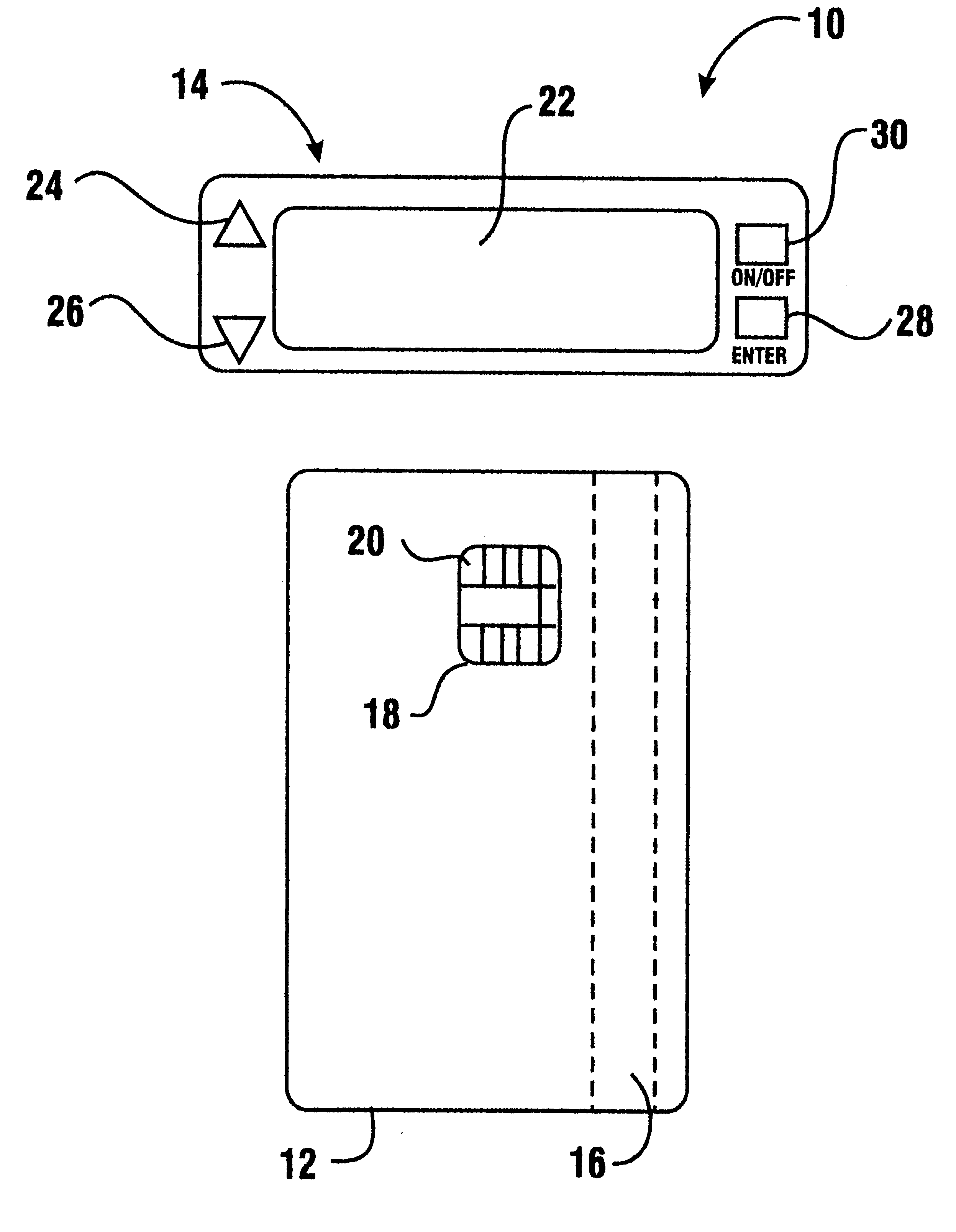

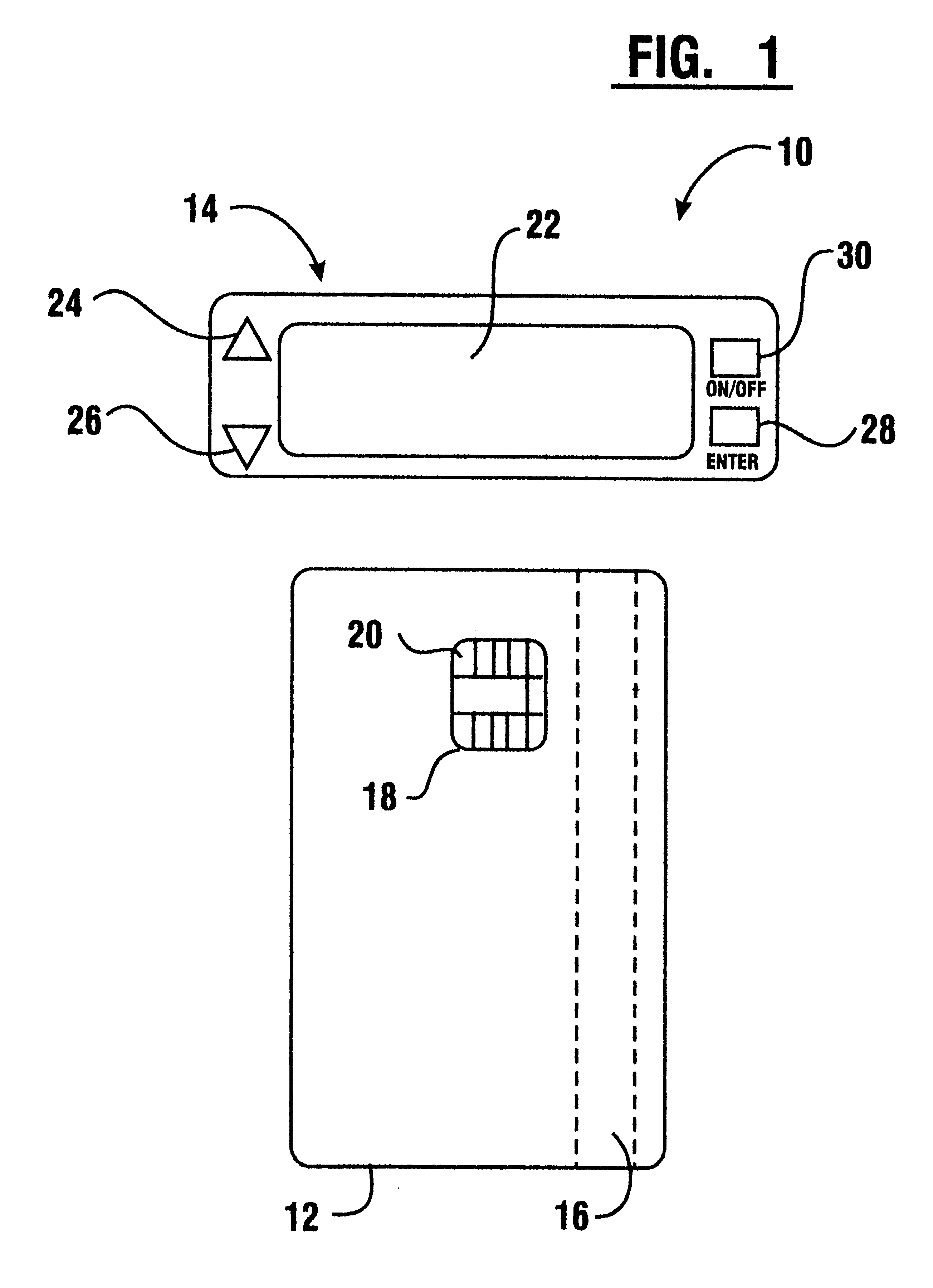

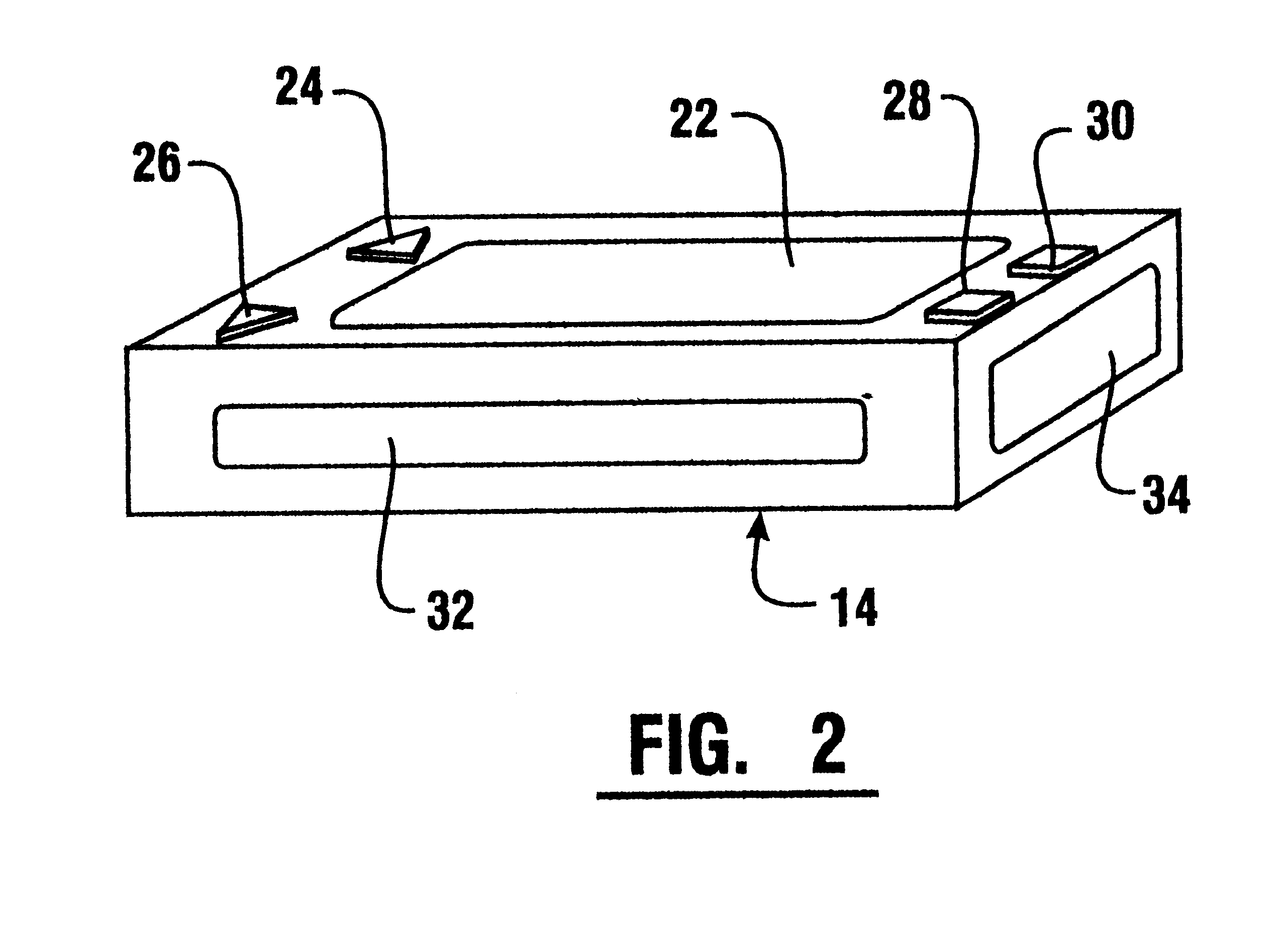

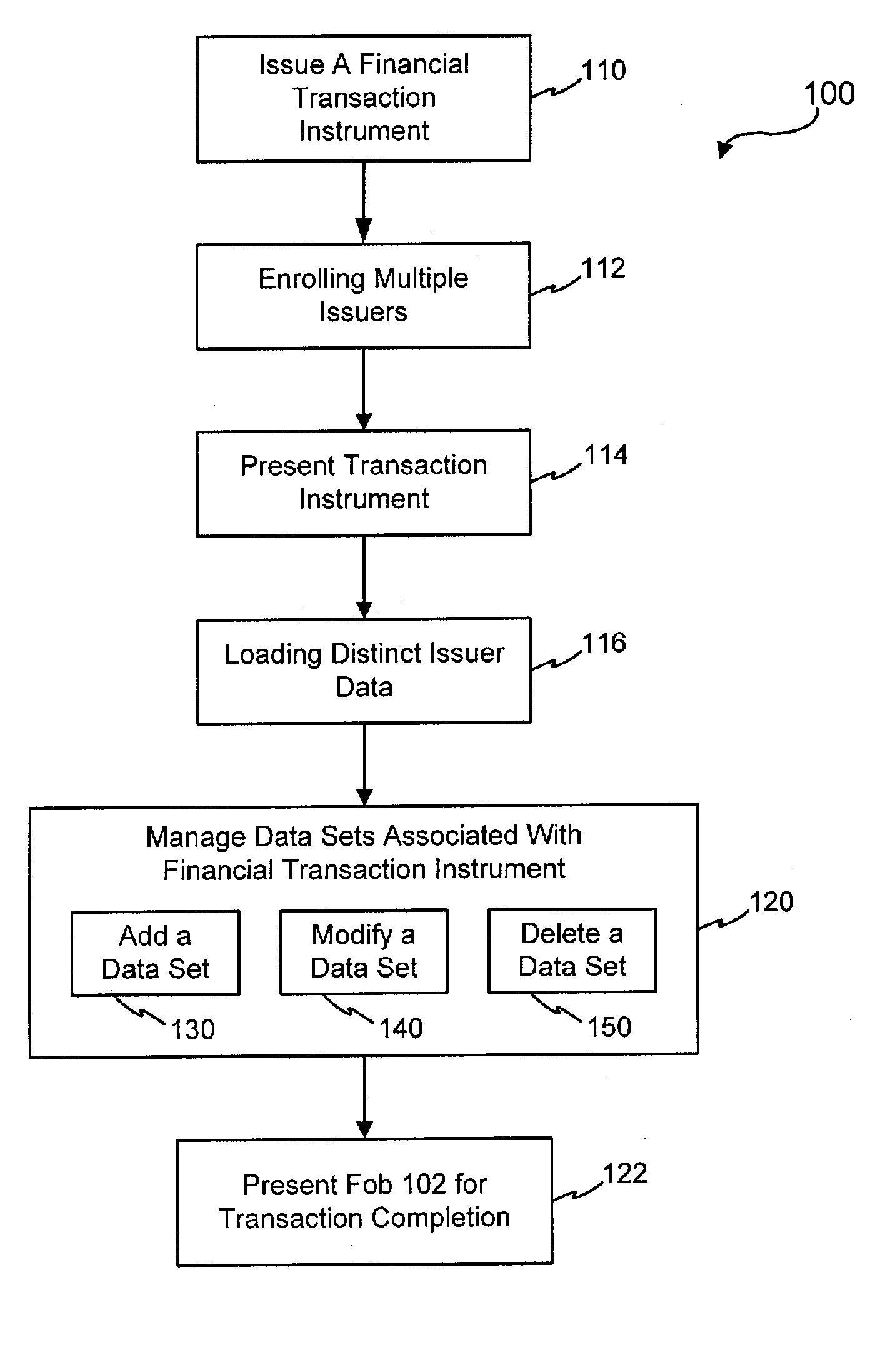

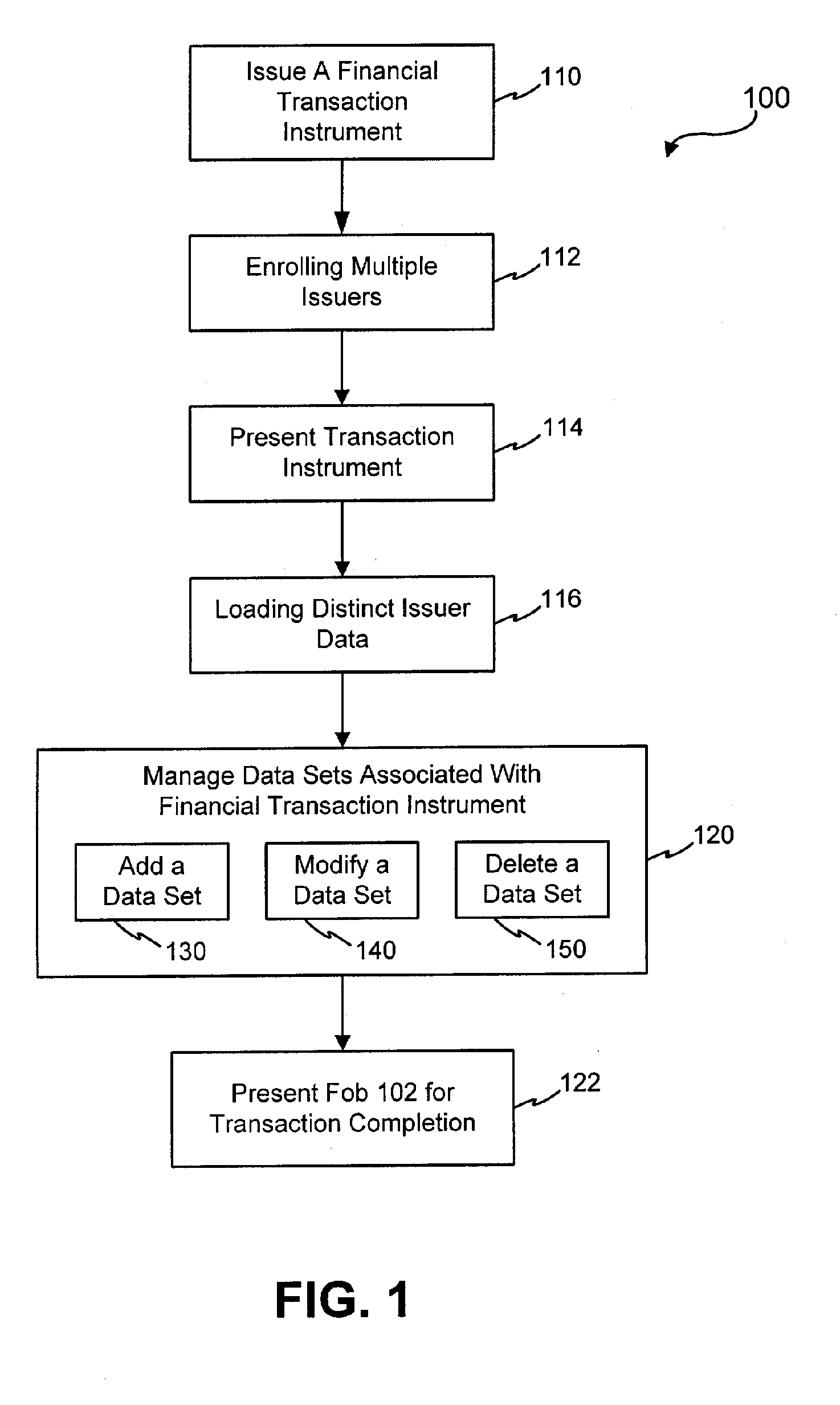

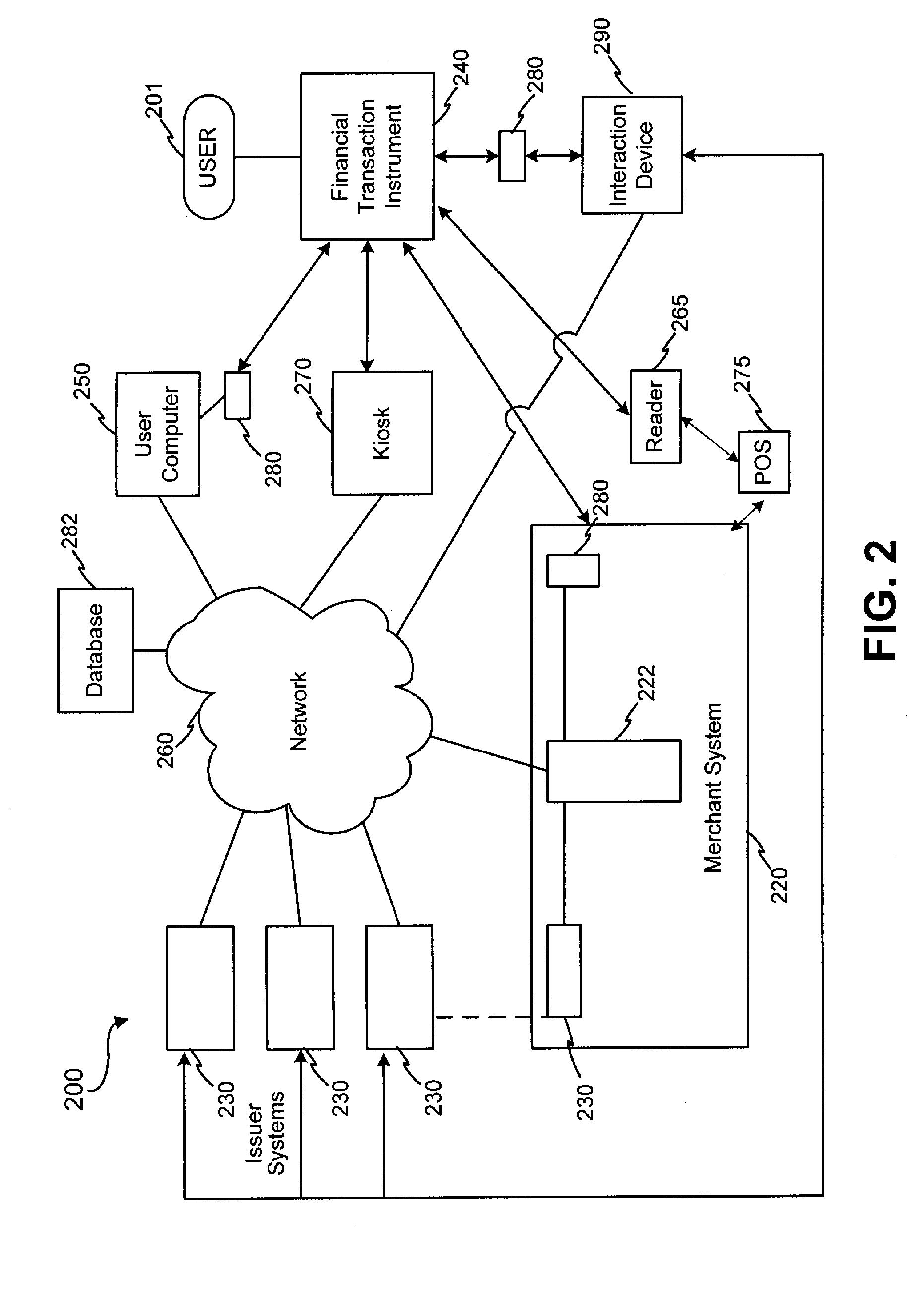

Systems and methods for managing multiple accounts on a RF transaction device using secondary identification indicia

InactiveUS20050171898A1Easy to manageEliminate needAcutation objectsFinanceData setFinancial transaction

Systems and methods are configured to manage data sets associated with a transaction device. For example, a method is provided for facilitating the management of distinct data sets on a transaction device that are provided by distinct data set owners, wherein the distinct data sets may include differing formats. The method includes the steps of: adding, by a read / write, a first data set to the financial transaction device, wherein the first data set is owned by a first owner; adding, by the read / write device, a second data set to the financial transaction device, wherein the second data set is owned by a second owner; and storing the first data set and the second data set on the financial transaction device in accordance with an owner defined format. The first and second data sets are associated with first and second owners, respectively, and are configured to be stored independent of each other The transaction device user may be permitted to select at least one of the multiple data sets for transaction completion using a secondary identifier indicia. Where the user selects multiple accounts for transaction completion, the user may be permitted to allocate portions of a transaction to the selected transaction accounts. The transaction request may be processed in accordance with the user's allocations.

Owner:LIBERTY PEAK VENTURES LLC

System and method for reallocating and/or upgrading and/or rewarding tickets, other event admittance means, goods and/or services

InactiveUS7031945B1To offer comfortIncrease the fun of activitiesMarket predictionsTicket-issuing apparatusPoint of saleUpgrade

Owner:EASTERN IX GRP +1

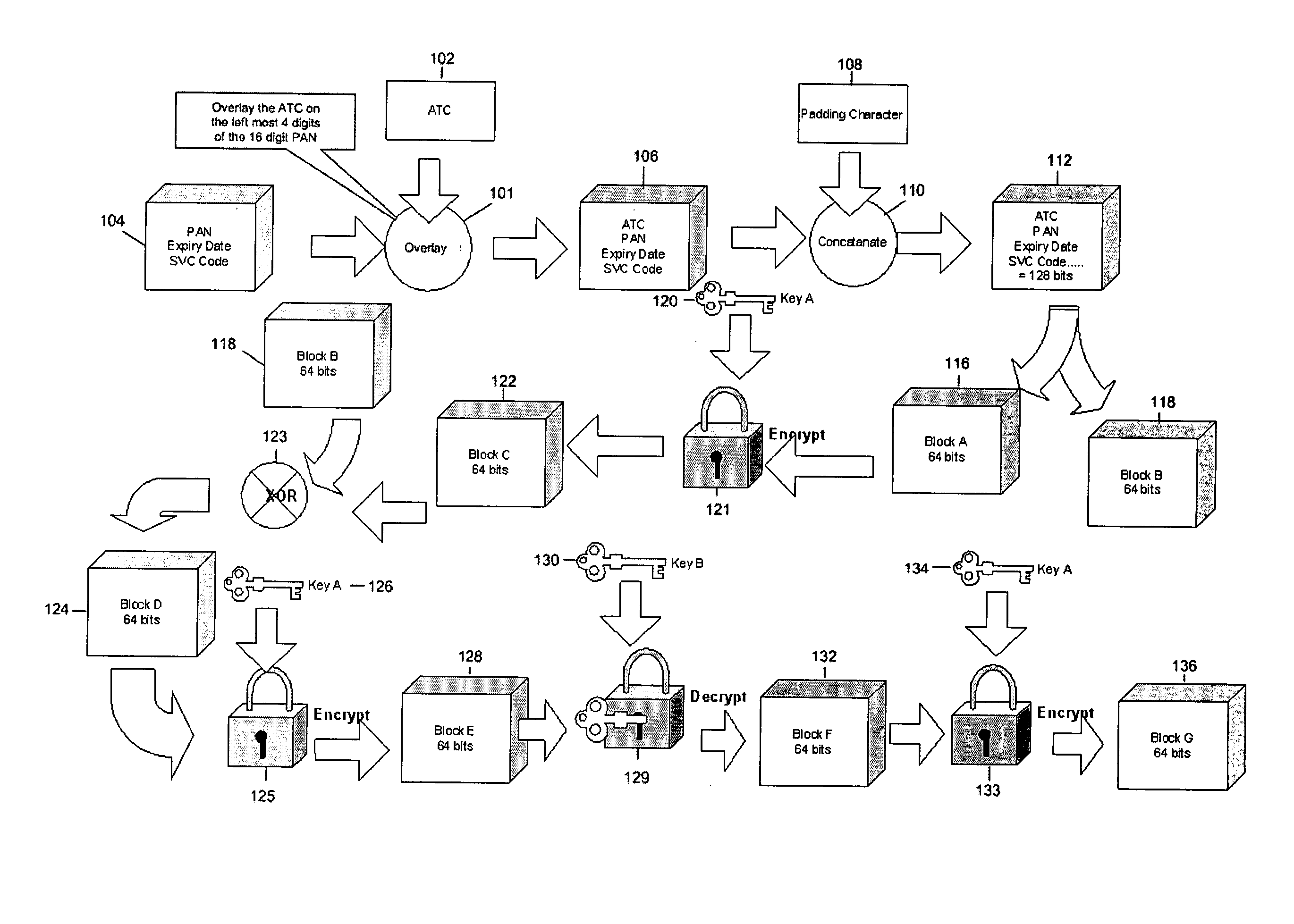

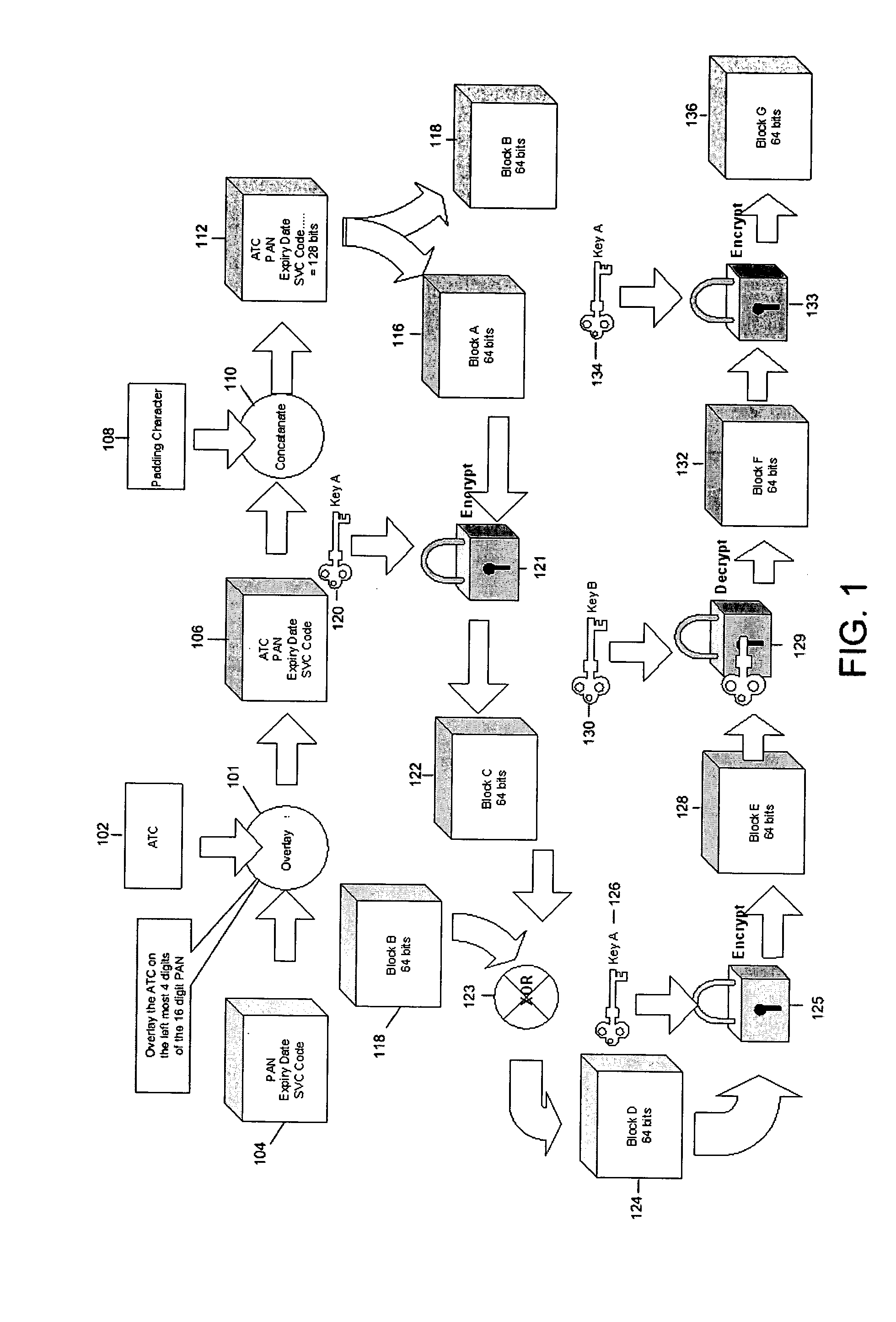

Method and system for generating a dynamic verification value

Methods and systems for dynamically generating a verification value for a transaction and for utilizing such value to verify the authenticity of the payment service application. The dynamically created verification value may be generated on a payment device, such as an integrated circuit credit card or smart card, embedded into the payment data, and transmitted to a point of sale terminal. Alternatively, payment data is sent by a payment device to a point of sale terminal, which generates a verification value and embeds it into the payment data. The embedded verification value is used by a service provider to verify the authenticity of the transaction. The methods and systems may be used in a contactless (wireless) environment or a non-wireless environment.

Owner:VISA INT SERVICE ASSOC

Consumer interactive shopping system

InactiveUS20050040230A1Expand accessFunction increaseGuide needlesCredit registering devices actuationComputer terminalPortable data terminal

Owner:SYMBOL TECH LLC

Onetime passwords for smart chip cards

ActiveUS8095113B2Unauthorised/fraudulent call preventionEavesdropping prevention circuitsDisplay deviceFinancial transaction

A financial transaction card is provided according to various embodiments described herein. The financial transaction card includes a card body with at least a front surface and a back surface. The financial transaction card may also include a near field communications transponder and / or a magnetic stripe, as well as a digital display configured to display alphanumeric characters on the front surface of the card body. The financial transaction card may also include a processor that is communicatively coupled with the near field communications transponder or magnetic stripe and the digital display. The processor may be configured to calculate one-time passwords and communicate the one-time passwords to both the near filed communications transponder or magnetic stripe and the digital display.

Owner:FIRST DATA

Biometric authentication of mobile financial transactions by trusted service managers

ActiveUS20090307139A1Digital data processing detailsUser identity/authority verificationUser inputFinancial transaction

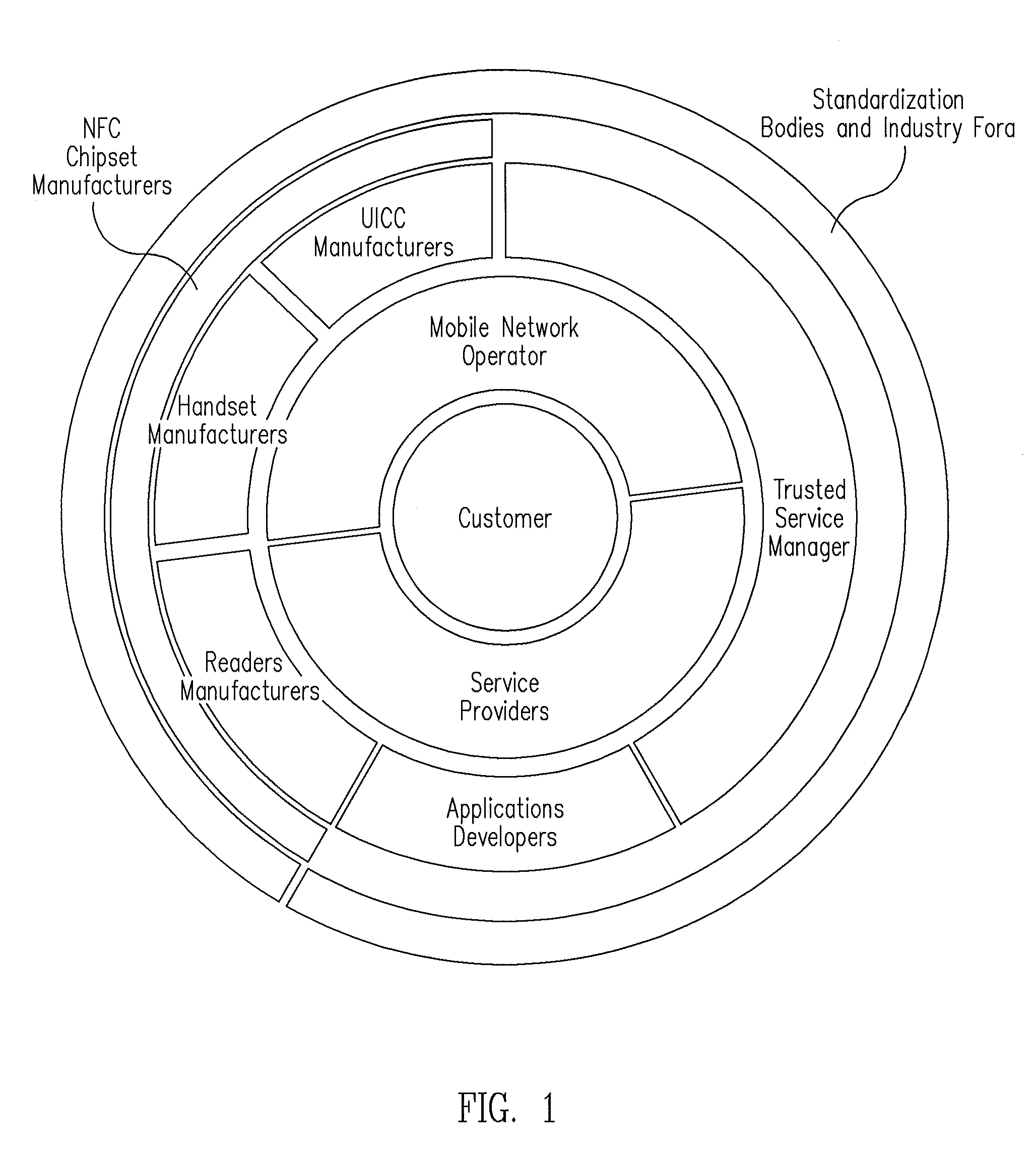

A method for authenticating a financial transaction at a point of sale (POS) includes storing an application program in a first secure element of a mobile phone. The application is configured to generate instruction codes to effect the financial transaction upon verification of a user's identity. The user's credentials are stored in a second SE of the phone, which is operable to verify the user's identity from a biometric trait of the user input to the phone and to generate data authenticating the financial transaction in response to the verification of the user's identity. At the POS, the user invokes the application and then inputs a biometric trait to the phone. The second SE verifies the user's identity, and upon verification, generates data authenticating the transaction. The financial transaction data, including the instruction codes and the authenticating data, are then transmitted from the phone to the POS.

Owner:PAYPAL INC

Personal shopping system

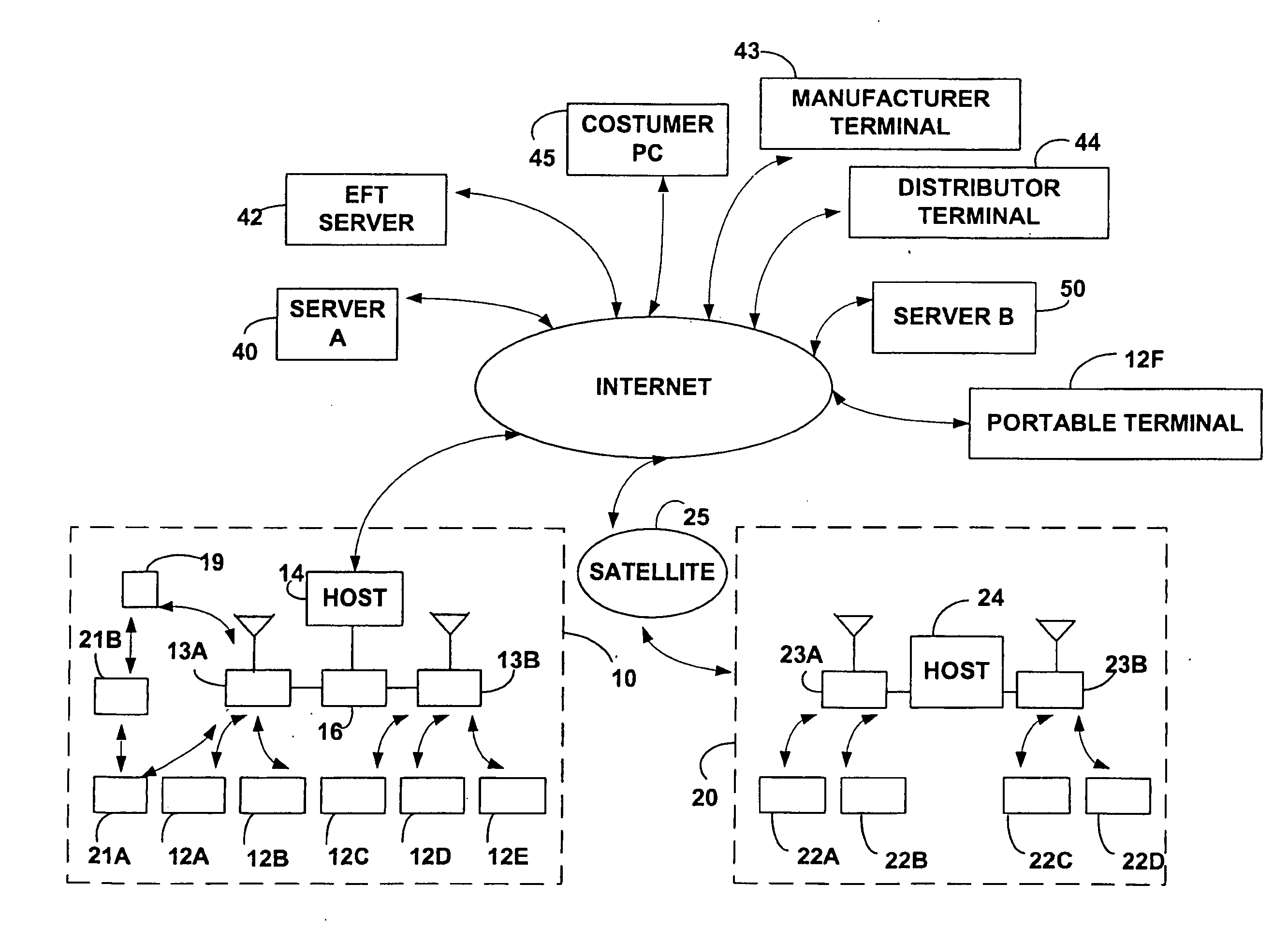

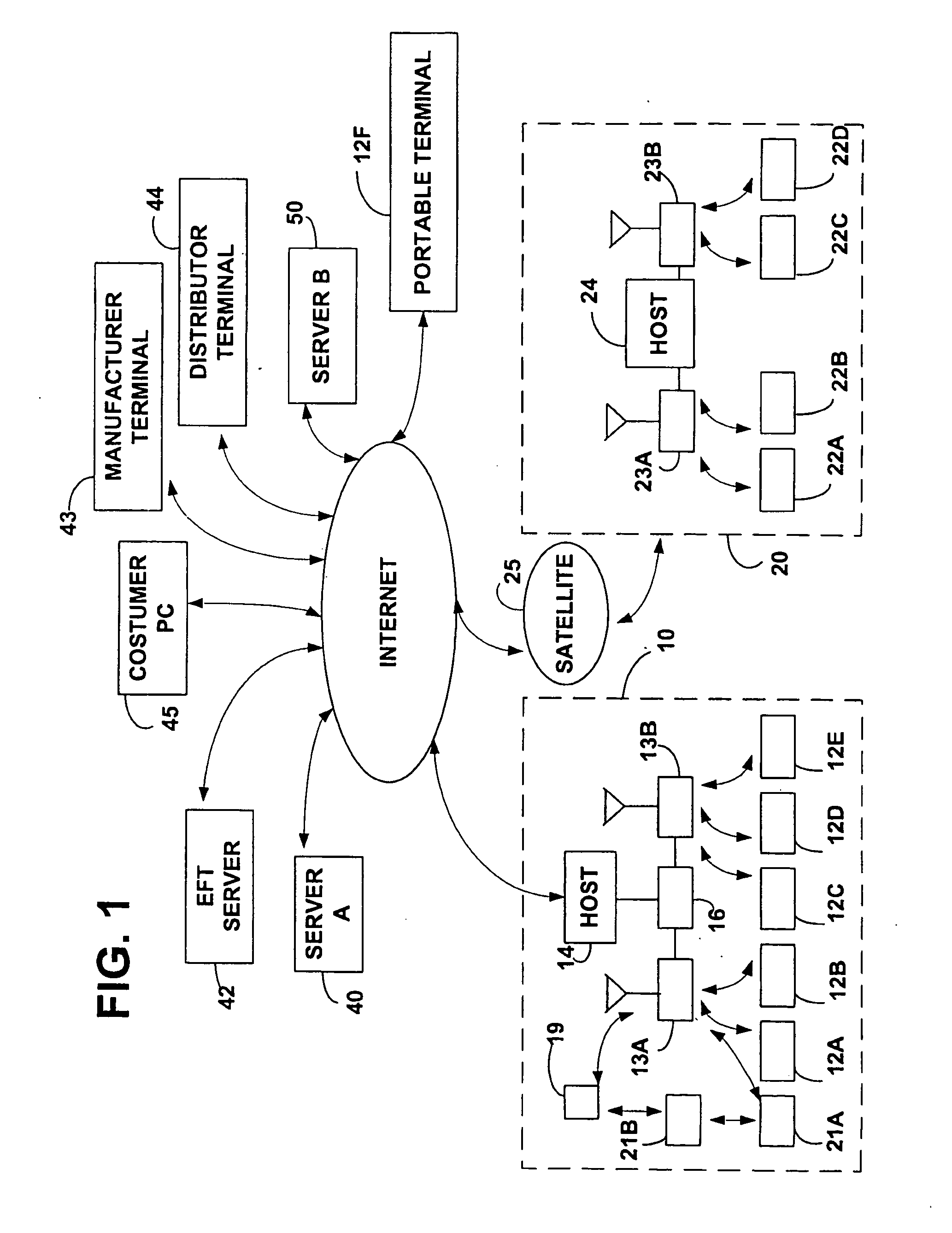

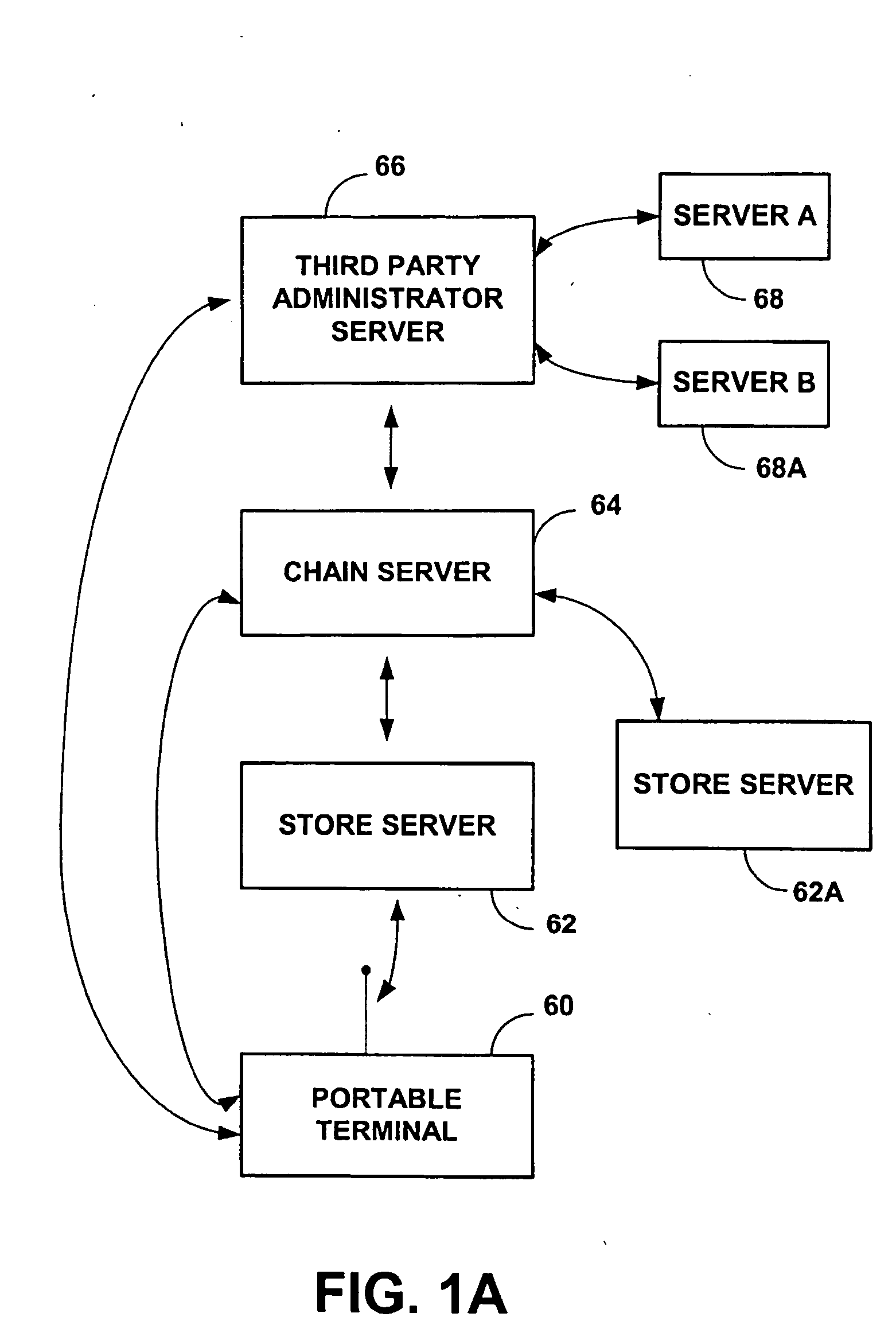

The present invention relates to a personal shopping system for combined use in both the home of a user and a shopping establishment. The system includes a host computer which is coupled to a host modem and, optionally, to at least one wireless multi-access point. The portable terminal can be used in both the shopping establishment and the home of the user. It is configured to read bar codes associated with items related to shopping, and includes a memory, a bar code reader, a wireless transceiver, and a data interface. The data interface of the terminal communicates with a data interface of the shopping establishment kiosk cradle or directly with the shopping establishment's communications network.

Owner:SYMBOL TECH LLC

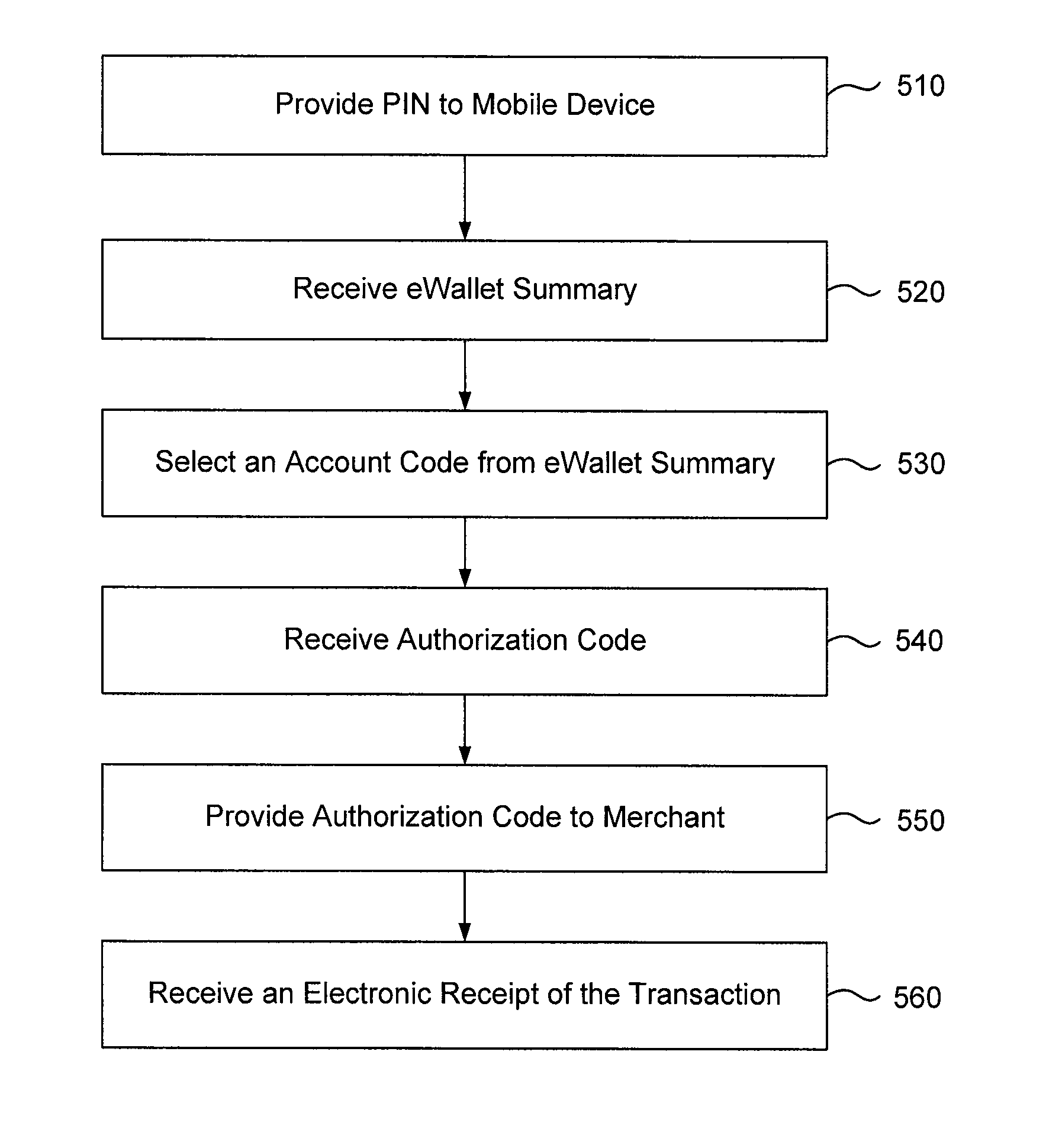

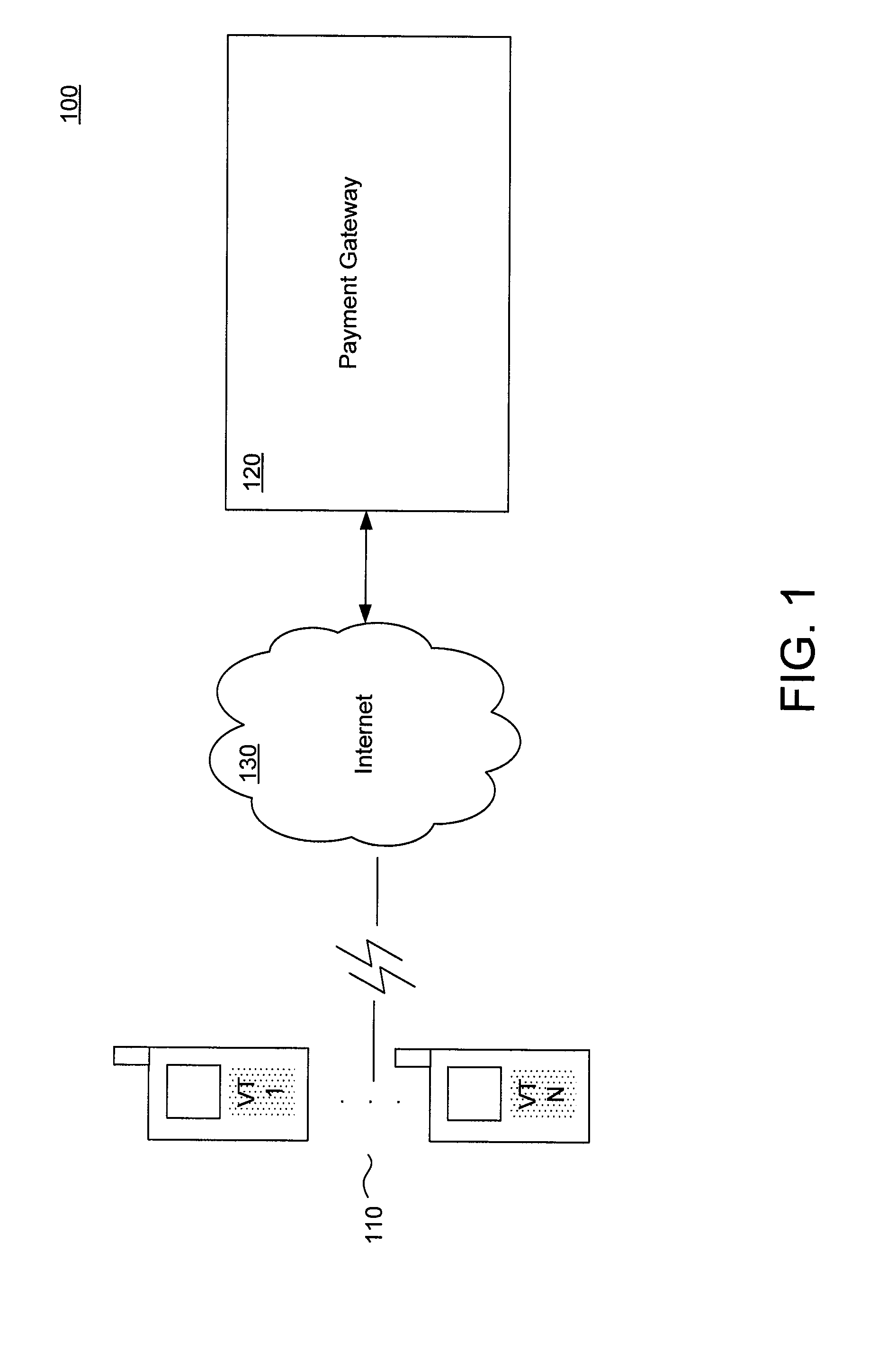

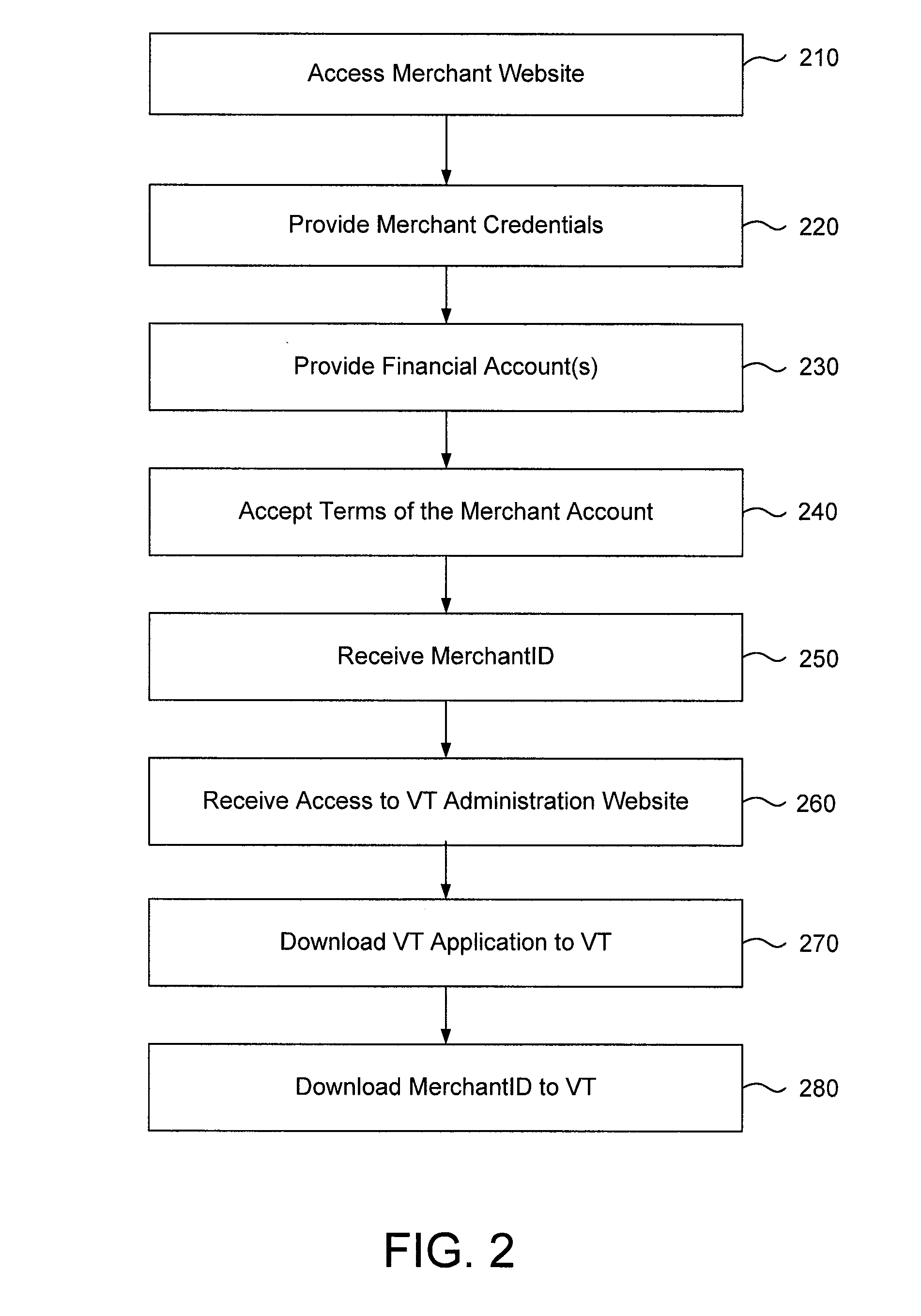

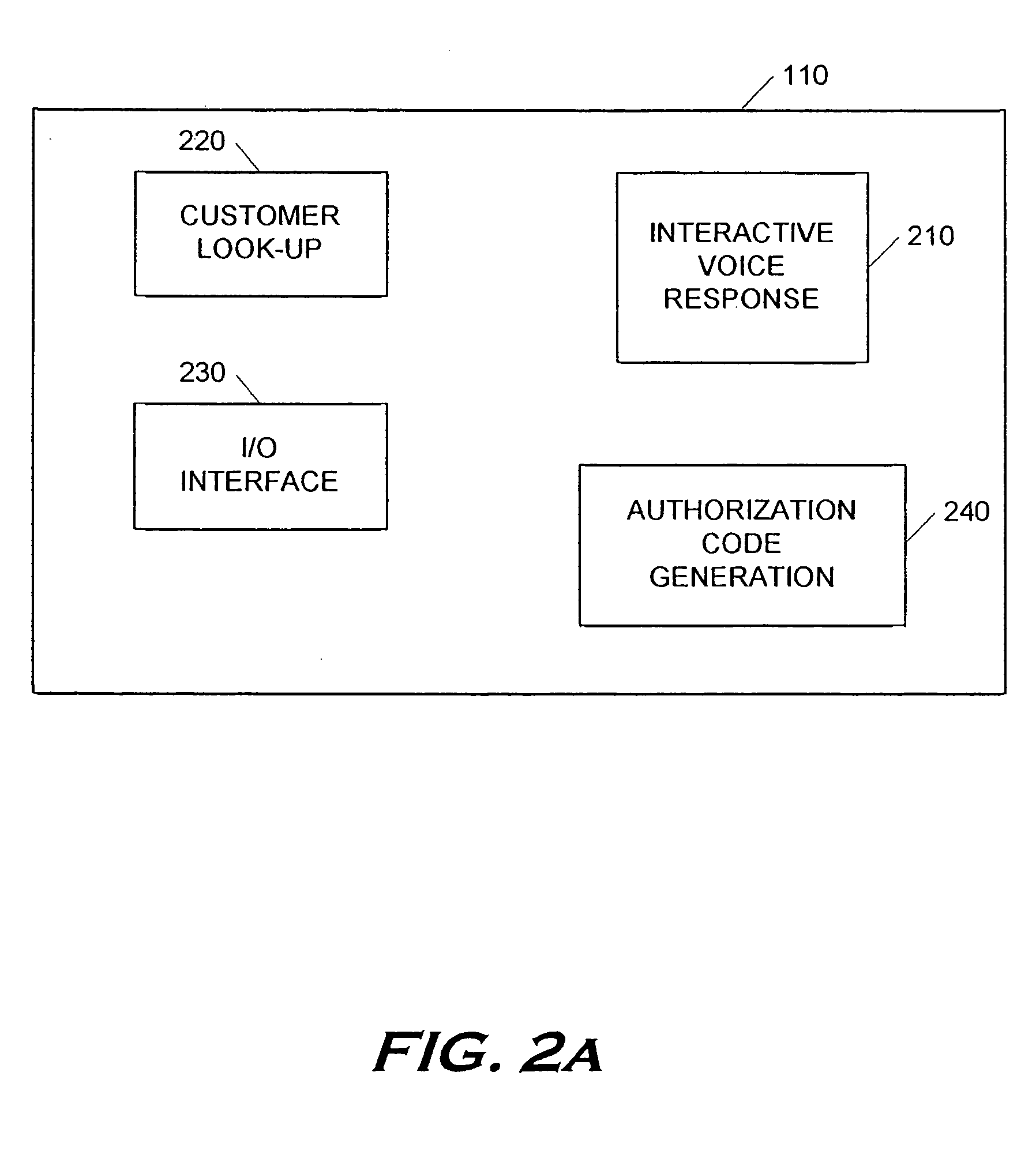

Method and System for Processing Secure Wireless Payment Transactions and for Providing a Virtual Terminal for Merchant Processing of Such Transactions

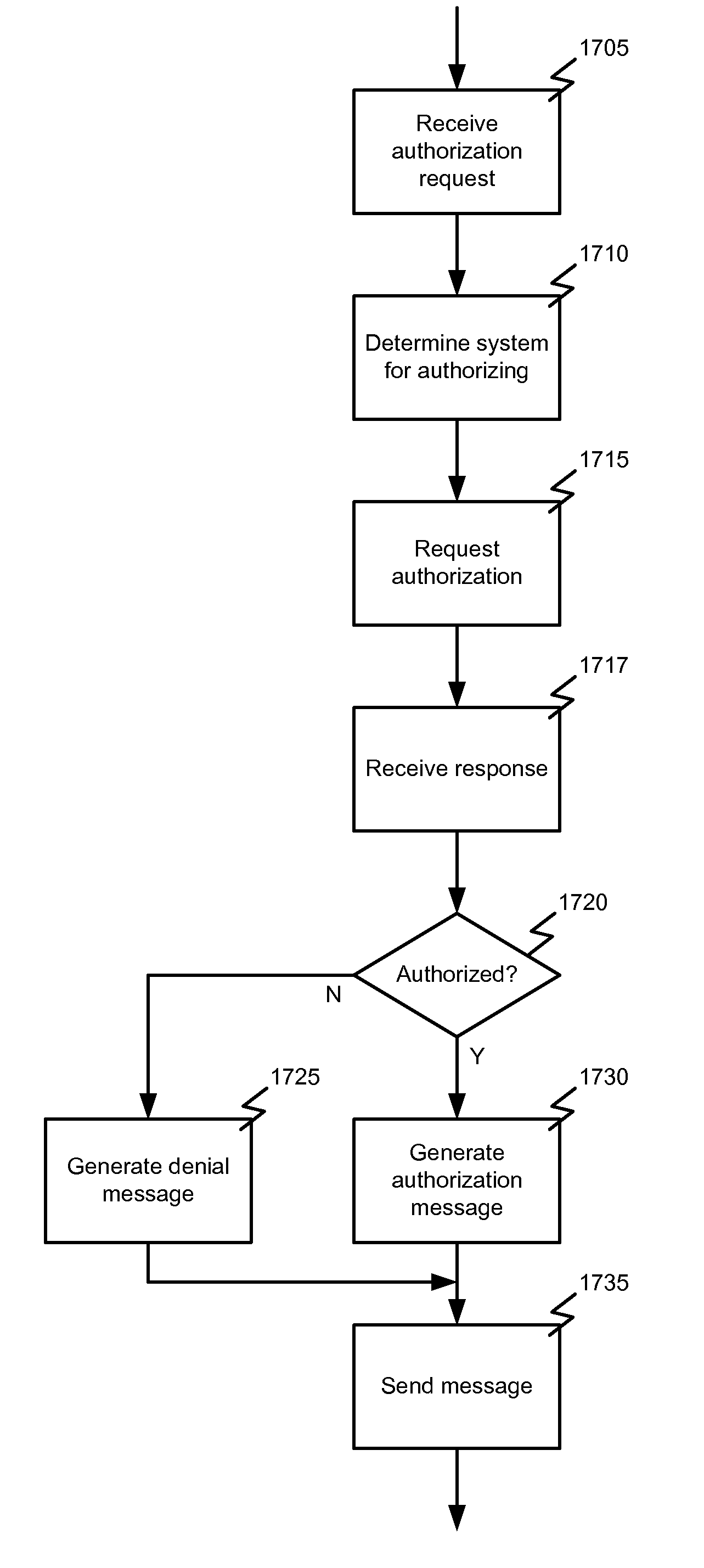

A system and method for processing a wireless electronic payment transaction is described. One embodiment comprises receiving a transaction authorization request for an electronic payment transaction from a customer, the authorization request submitted from a mobile communication device of the customer; authenticating the transaction authorization request; authorizing the transaction authorization request and transmitting an authorization code to the mobile communication device, the authorization code being communicated to a merchant from the customer; receiving a transaction approval request from the merchant, the transaction approval request submitted from a virtual terminal associated with the merchant, the virtual terminal being a wireless communication device having a point of sale processing application installed therein; authenticating the transaction approval request; approving the transaction approval request and transmitting an approval code to the virtual terminal; and generating and executing transaction settlement instructions between a financial account of the customer and a financial account of the merchant.

Owner:MOCAPAY

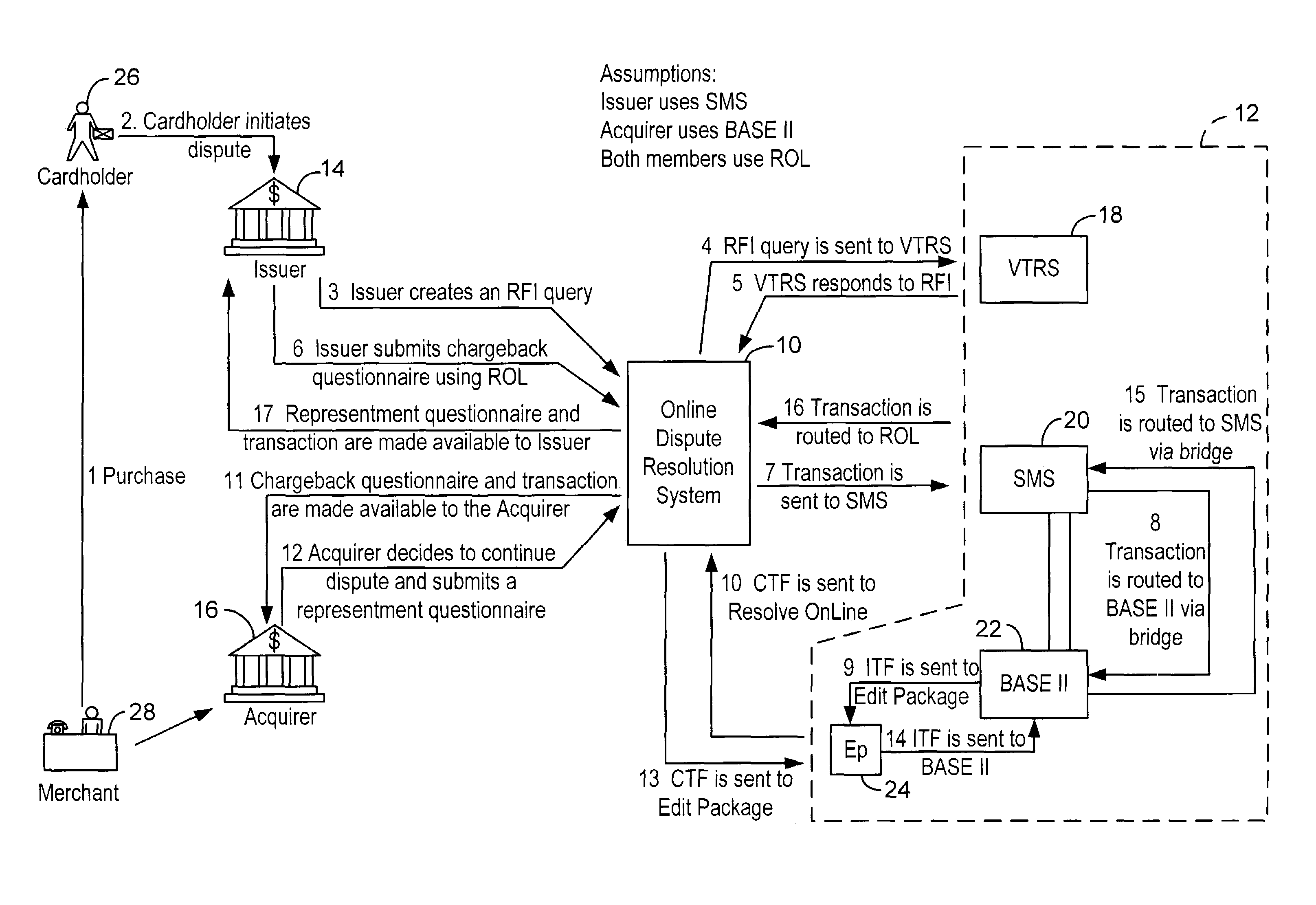

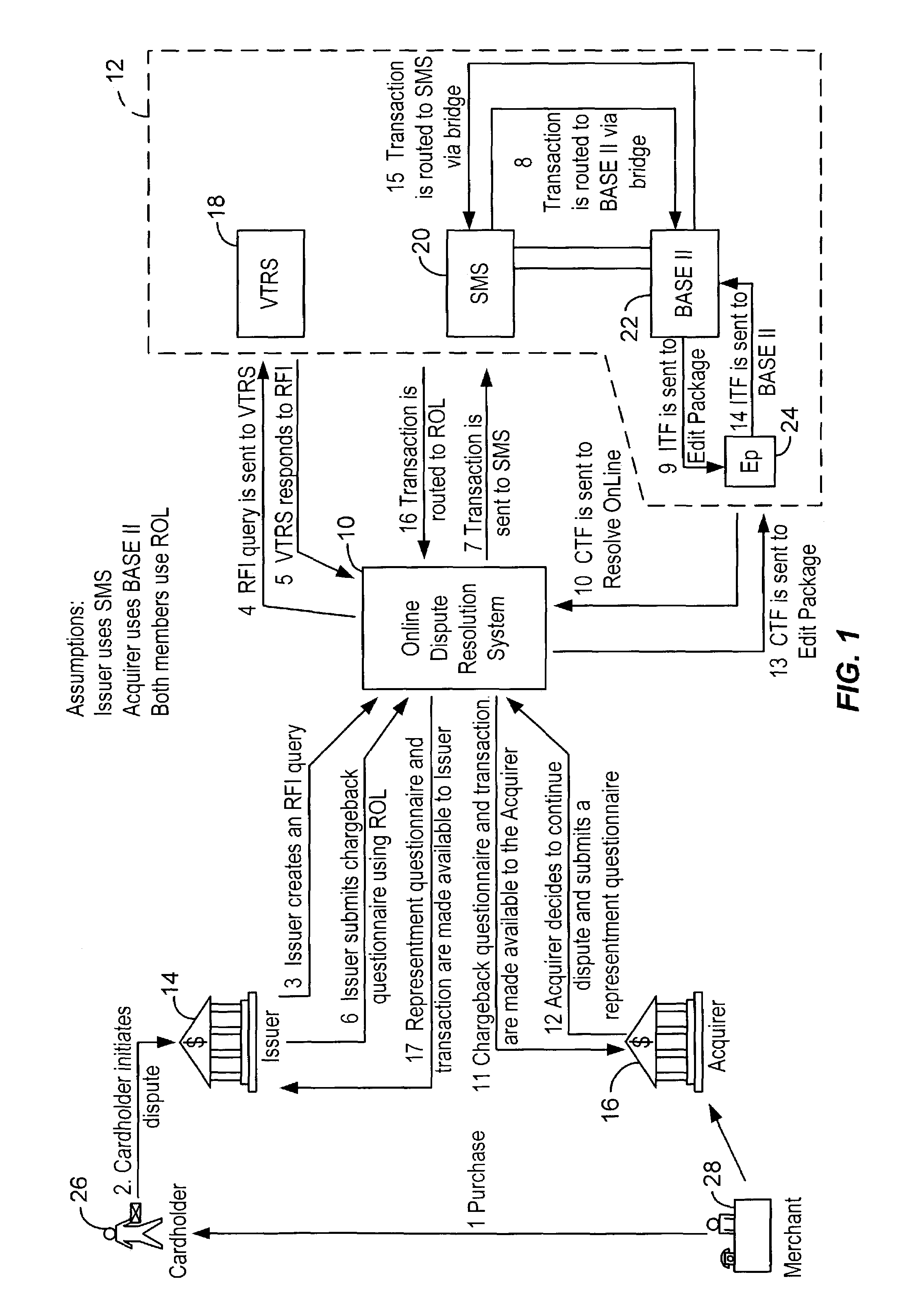

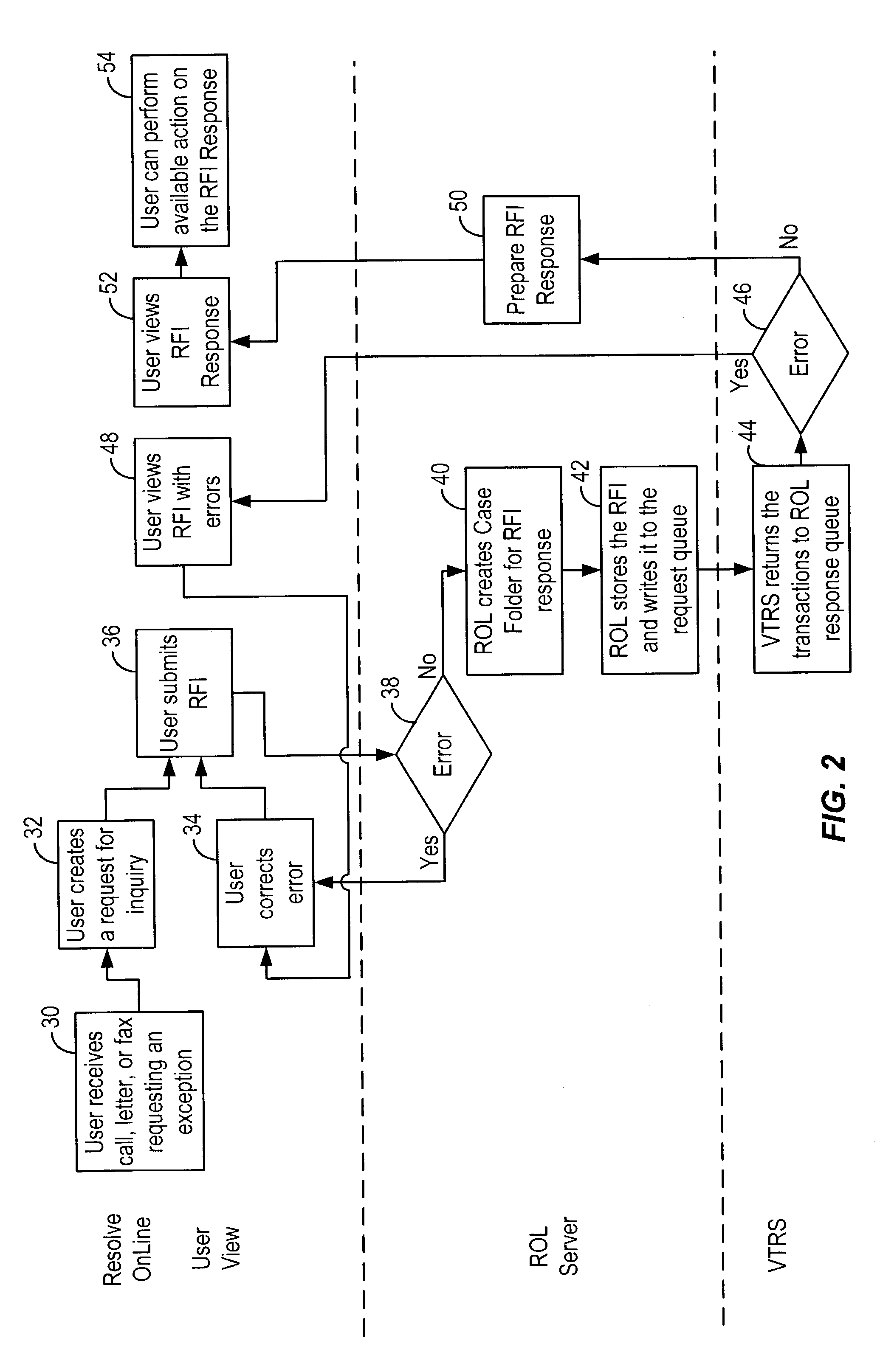

Method and system for facilitating electronic dispute resolution

A system for facilitating payment transaction disputes is provided. According to one aspect of the system, a user, such as an issuer, is allowed to use the system to resolve a disputed transaction. Based on information provided by a cardholder, the issuer is able to use the system to retrieve transactional information relating to the disputed transaction reported by the customer for review. When the issuer uses the system to retrieve information relating to the disputed transaction, a case folder is created. The case folder is a repository for storing all the relevant information and documentation relating to the disputed transaction. Using the information retrieved by the system, the issuer then determines whether to initiate a dispute. Alternatively, the system can also be used by an acquirer to respond to a dispute, usually on behalf of one of its merchant. If a dispute is responded to, a questionnaire is then created by the system. Alternatively, the issuer may decline to initiate a dispute and either seek additional information from the cardholder or deny the cardholder's inquiry. The case folder and the questionnaire are created for a specific disputed transaction. The questionnaire is designed to capture information from the cardholder and / or the issuer relating to the disputed transaction. The questionnaire may be pre-populated with previously retrieved transactional information which is stored in the case folder. Relevant documents in support of the disputed transaction may also be attached as part of the questionnaire. Various parties to the dispute may then provide relevant information (including supporting documentation) to the system. The relevant information provided by the parties is maintained in the case folder. The system then keeps track of the relevant timeframes for the case folder to ensure that each party to the dispute is given the correct period of time to respond during the processing of a dispute. Prior to filing the dispute for arbitration or compliance, the system permits the parties to resolve the dispute amongst themselves without the help of an arbiter through pre-arbitration and pre-compliance. If the parties to the dispute are unable to resolve the dispute on their own, the system also permits the parties to resolve the dispute via arbitration or compliance with the help of an arbiter. The system provides the arbiter with access to the case folder to allow the arbiter to render an informed decision on the dispute.

Owner:VISA USA INC (US)

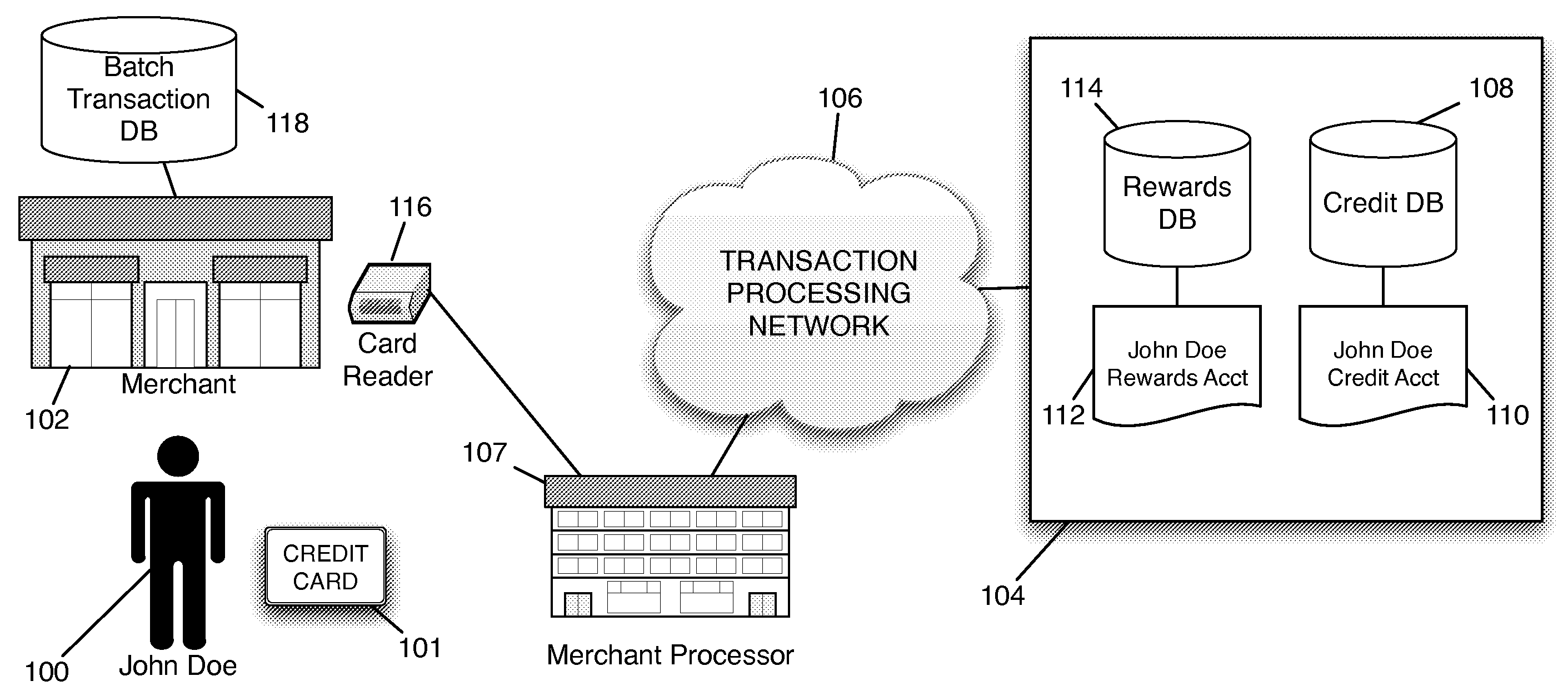

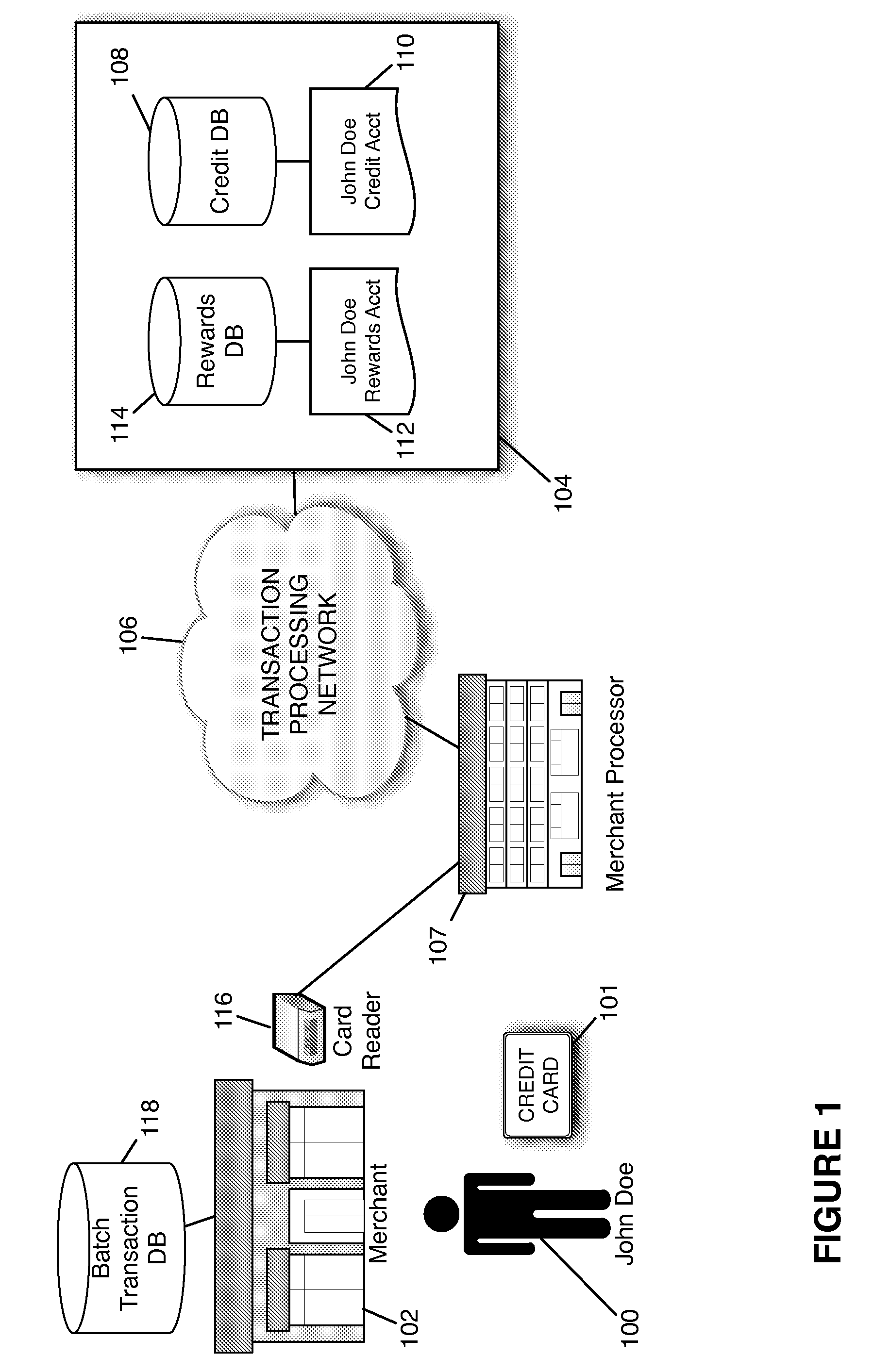

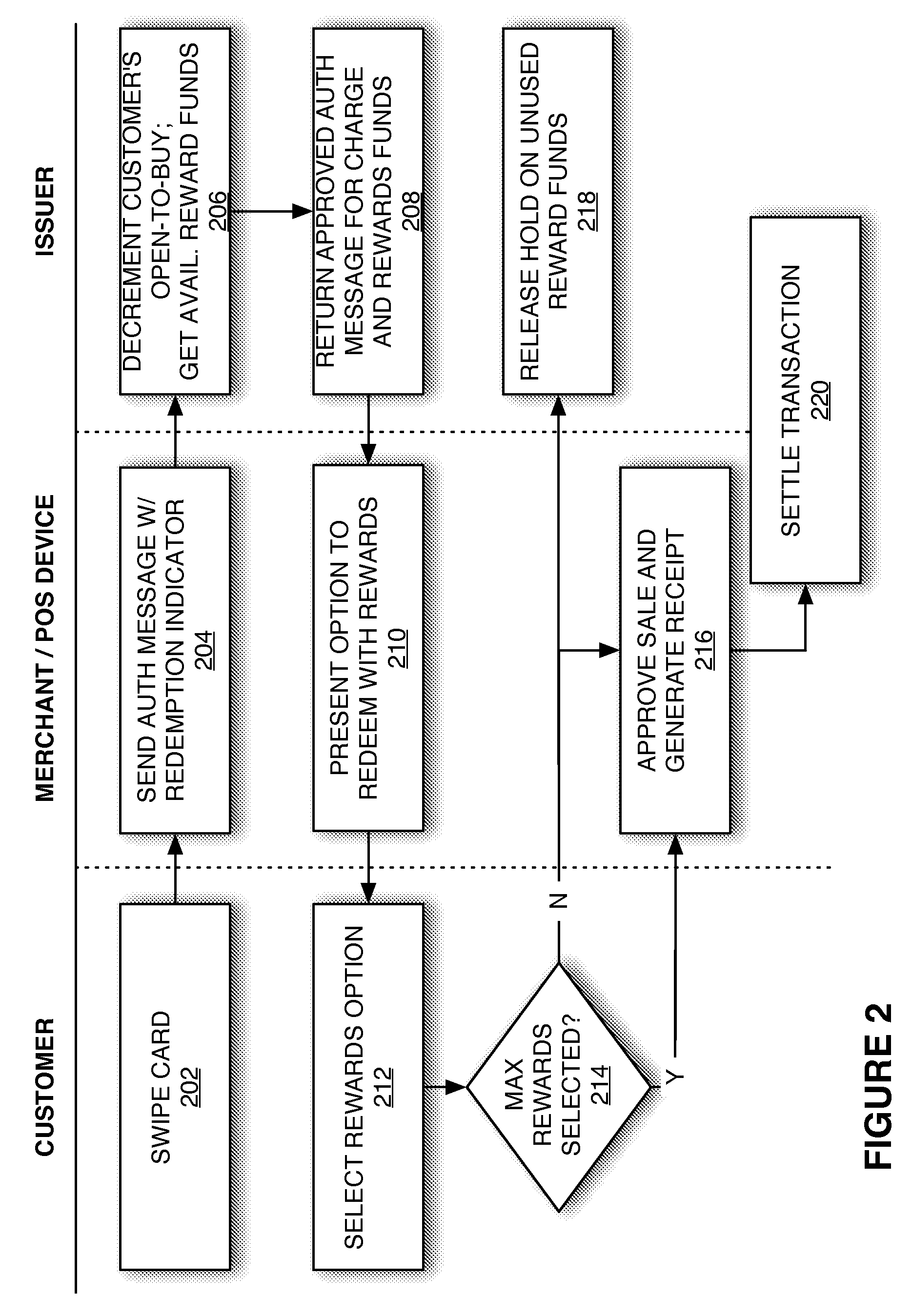

Redemption of Credit Card Rewards at a Point of Sale

Systems and methods are described for redeeming rewards at a merchant's point-of-sale. The reward redemption takes place in real time and can be accomplished without the active participation of the merchant. A single credit card with no additional information may be used with a single swipe from the consumer to access both credit and rewards accounts, such that a single authorization request is made to encompass both rewards and credit. Merchants can be fully compensated for transactions by the issuer despite the customer's choice to redeem rewards.

Owner:DFS SERVICES

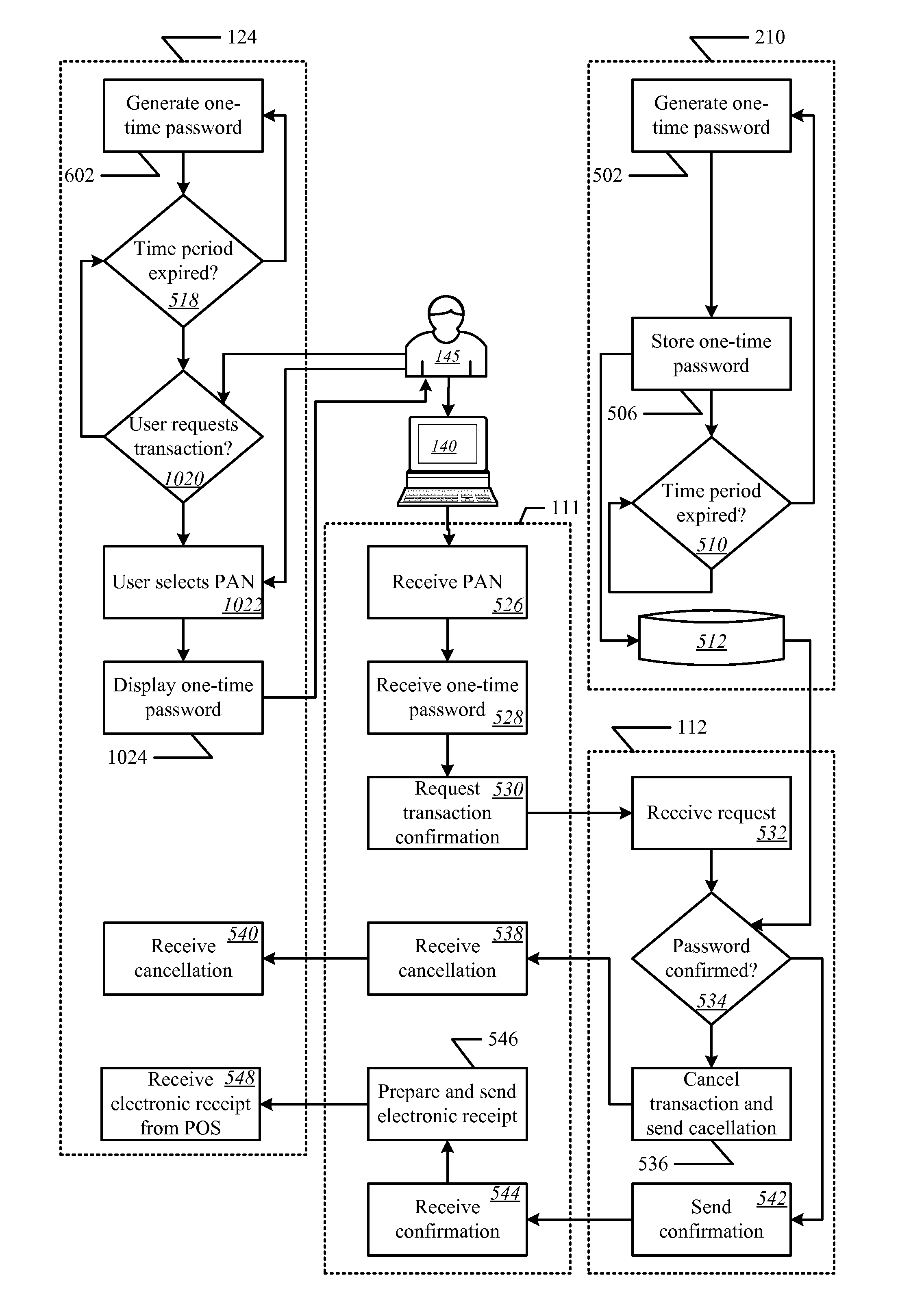

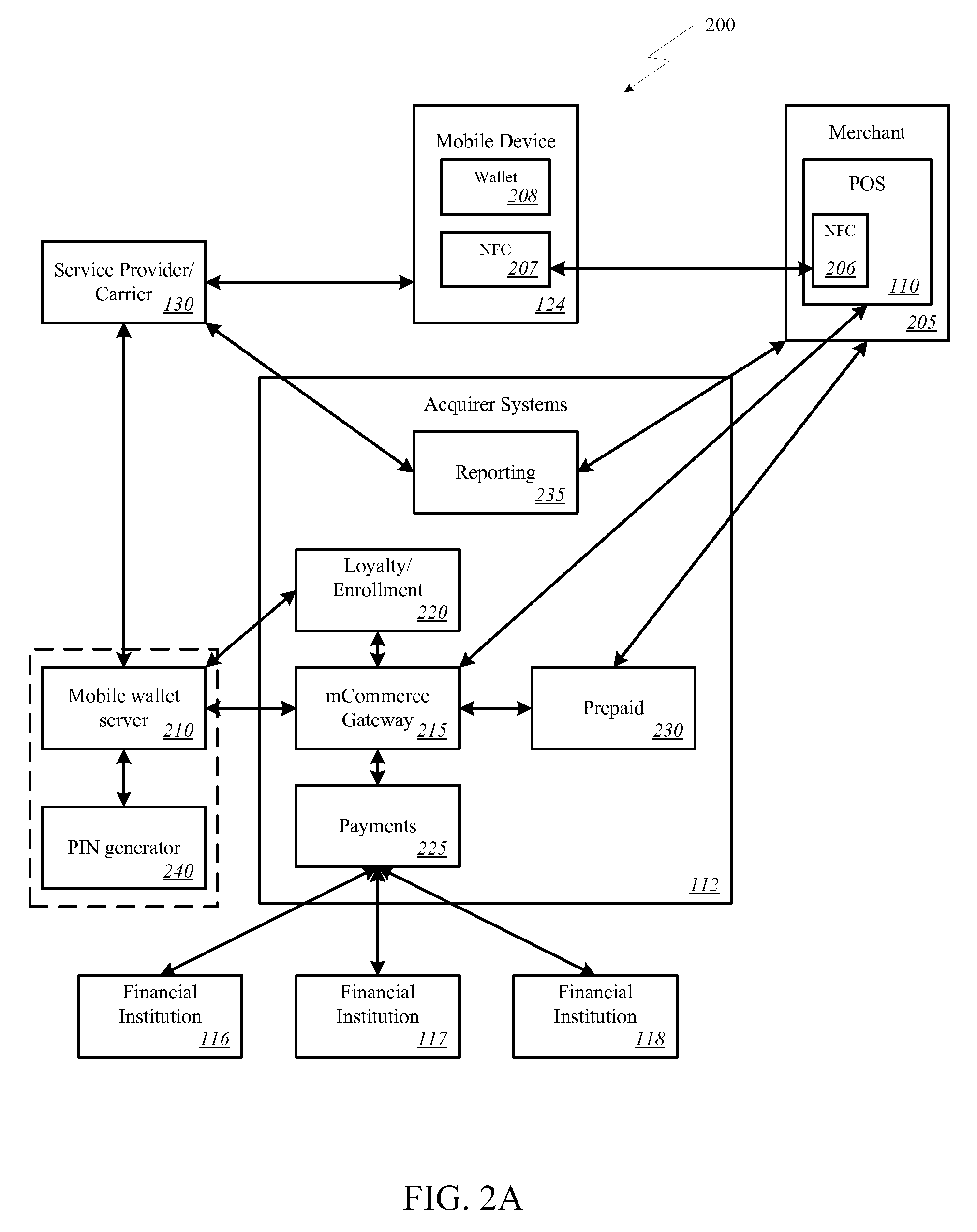

Onetime Passwords For Mobile Wallets

ActiveUS20090104888A1Near-field transmissionUnauthorised/fraudulent call preventionNetworked systemOne-time password

A mobile wallet and network system using onetime passwords for authentication is disclosed according to one embodiment of the invention. A onetime password may be generated at a mobile wallet server and transmitted to the mobile device. The onetime password may then be used to authenticate the user of the mobile wallet when completing a transaction. Authentication may require entry of the onetime password and confirmation that the onetime password entered matches the onetime password sent by the mobile wallet server. In other embodiments of the invention, a mobile wallet and a mobile wallet server are in sync and each generate the same onetime password at the same time. These onetime passwords may then be used to authenticate the user of the mobile wallet.

Owner:FIRST DATA

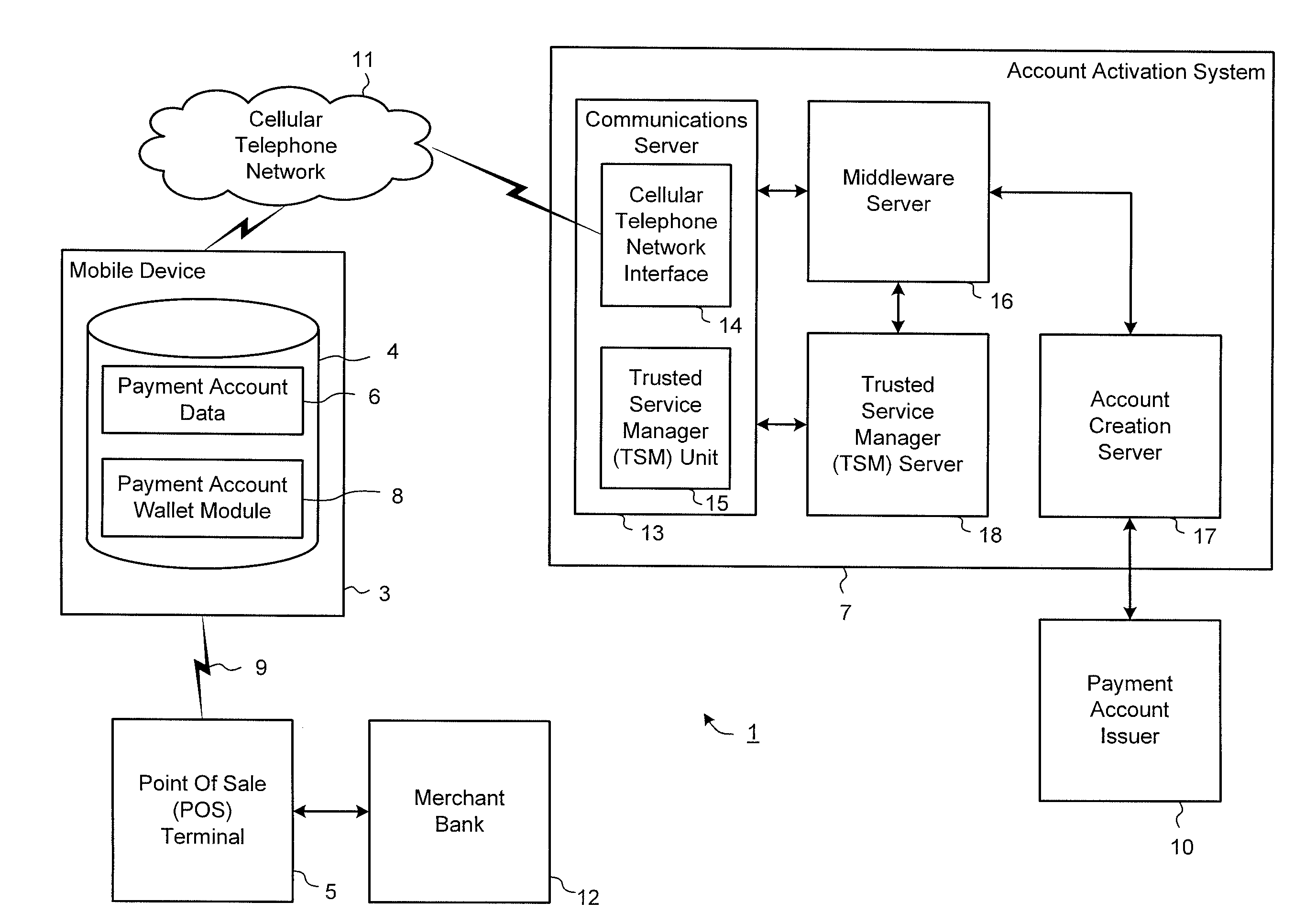

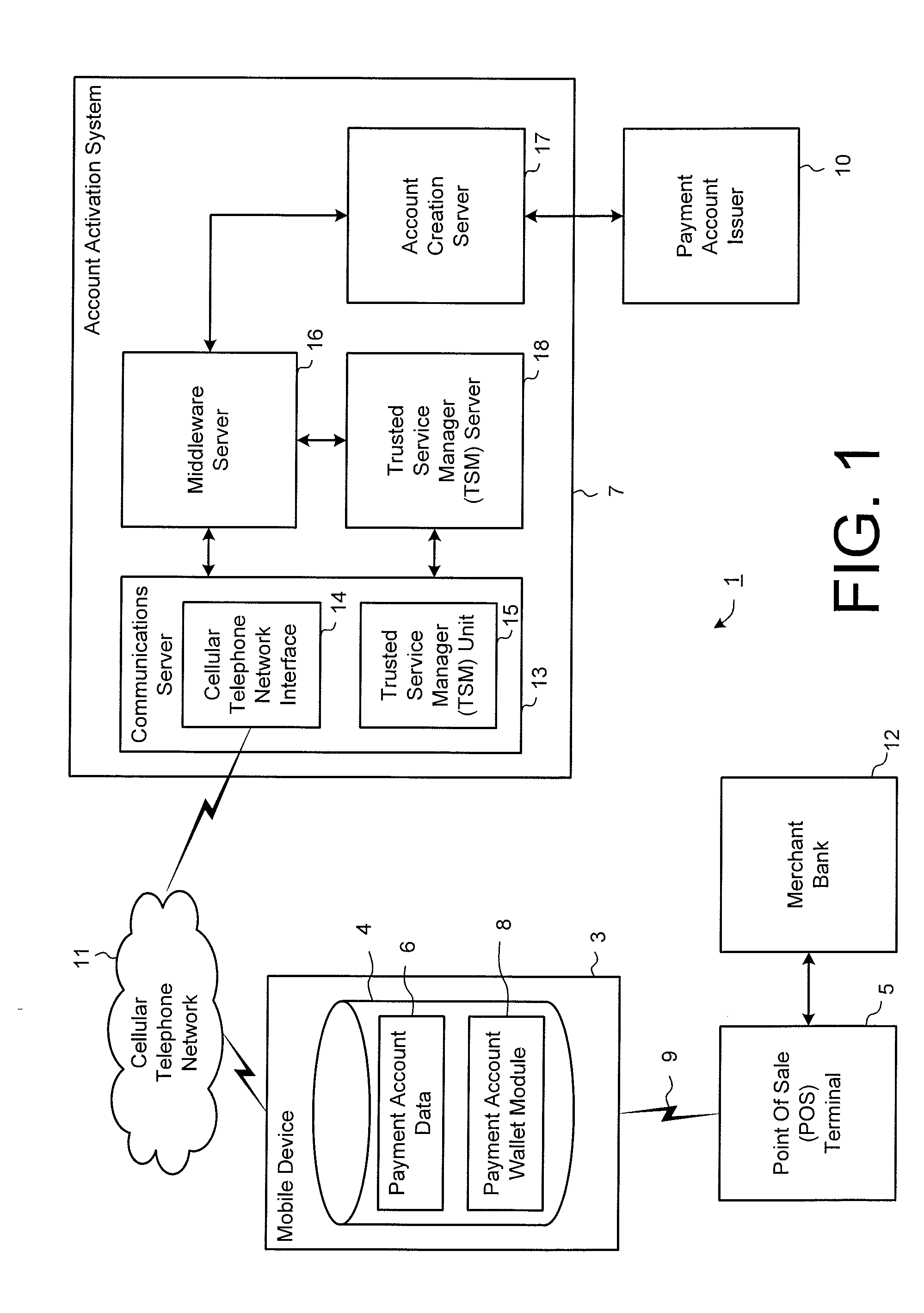

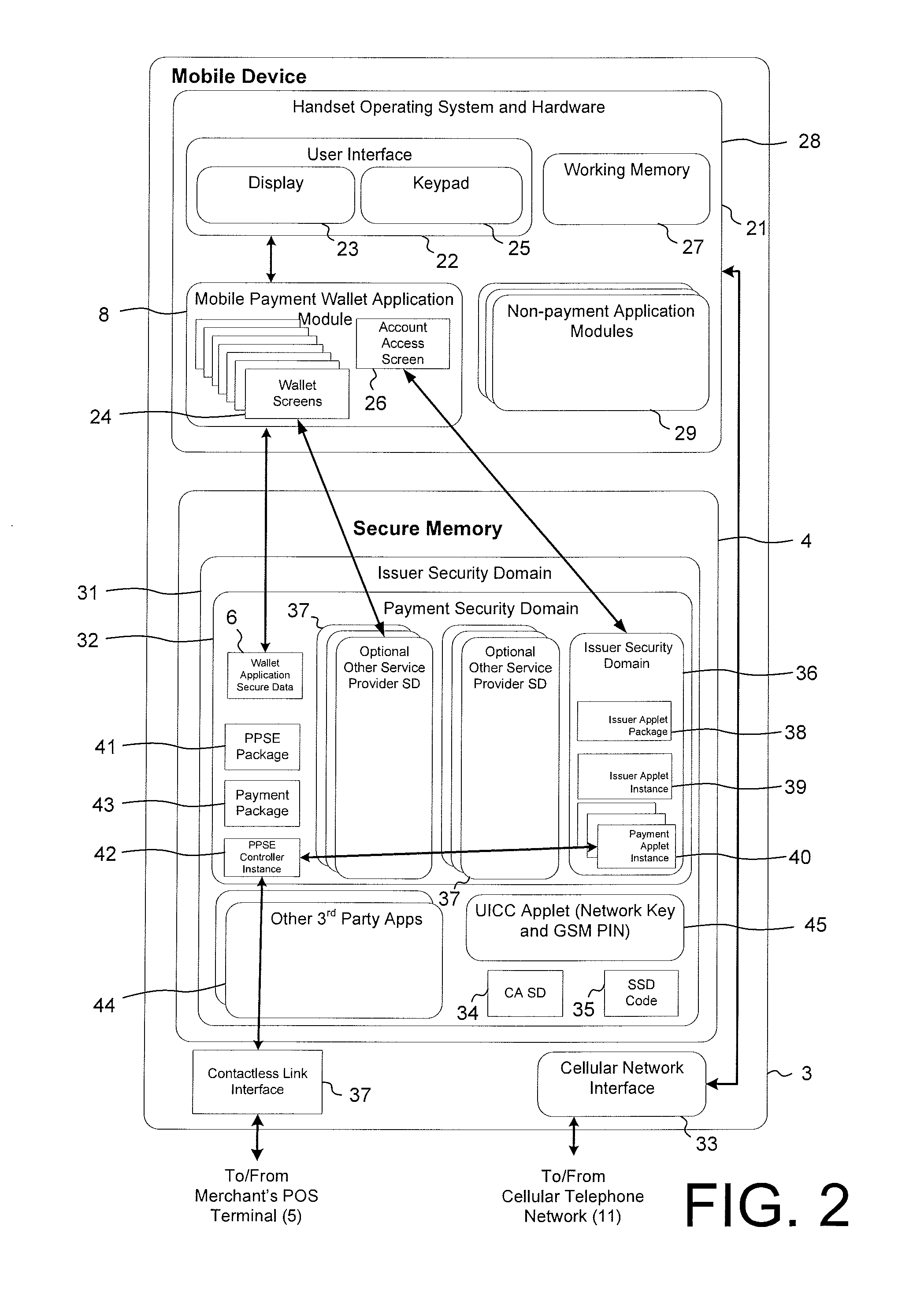

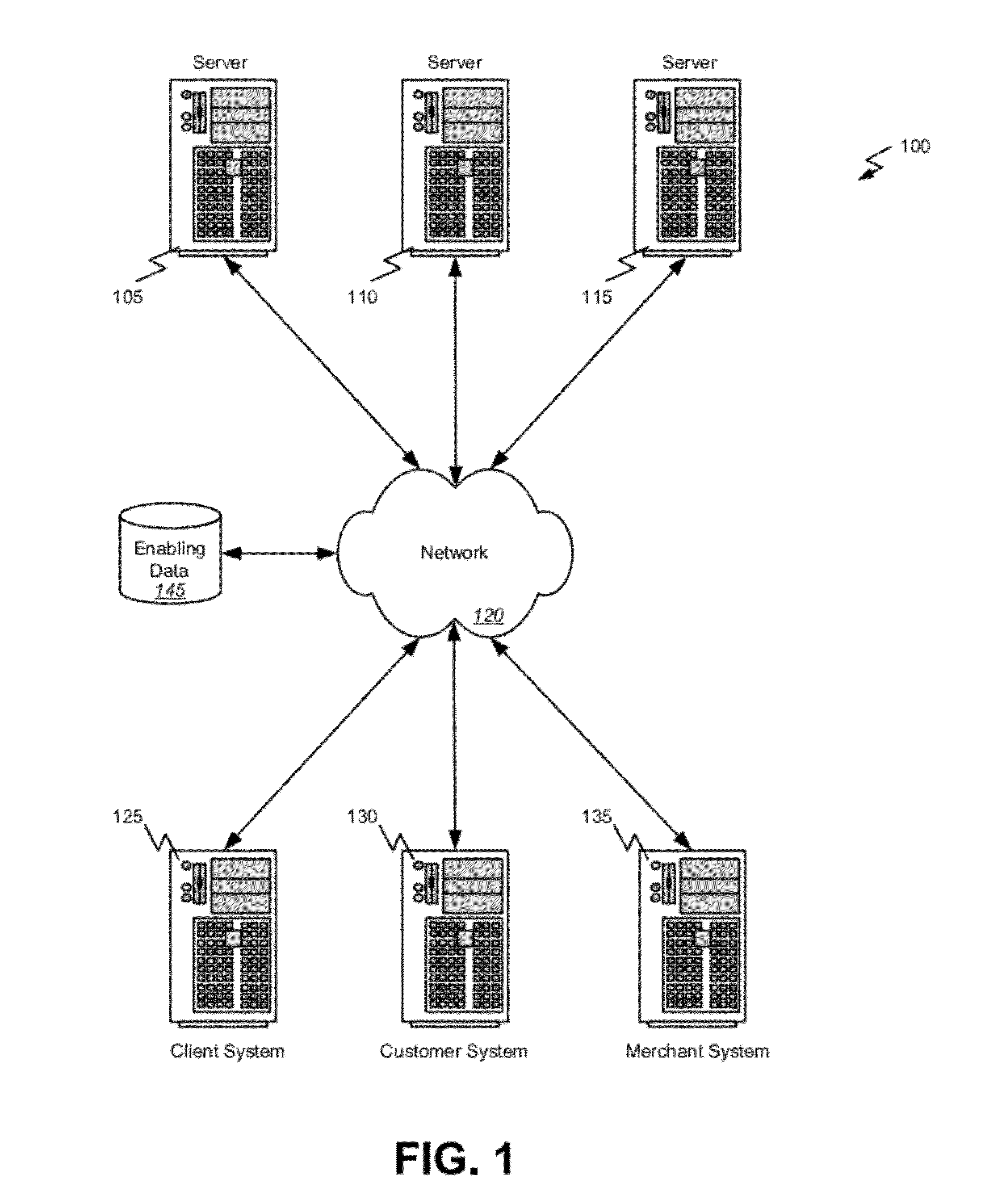

Secure account provisioning

ActiveUS20120078735A1Promote activationFinancePoint-of-sale network systemsComputer networkUser authentication

A mobile payment system and method are described that facilitates the secure and real time user authentication and activation of a mobile payment account for a user portable electronic device over a communications network.

Owner:BARCLAYS EXECUTION SERVICES LTD

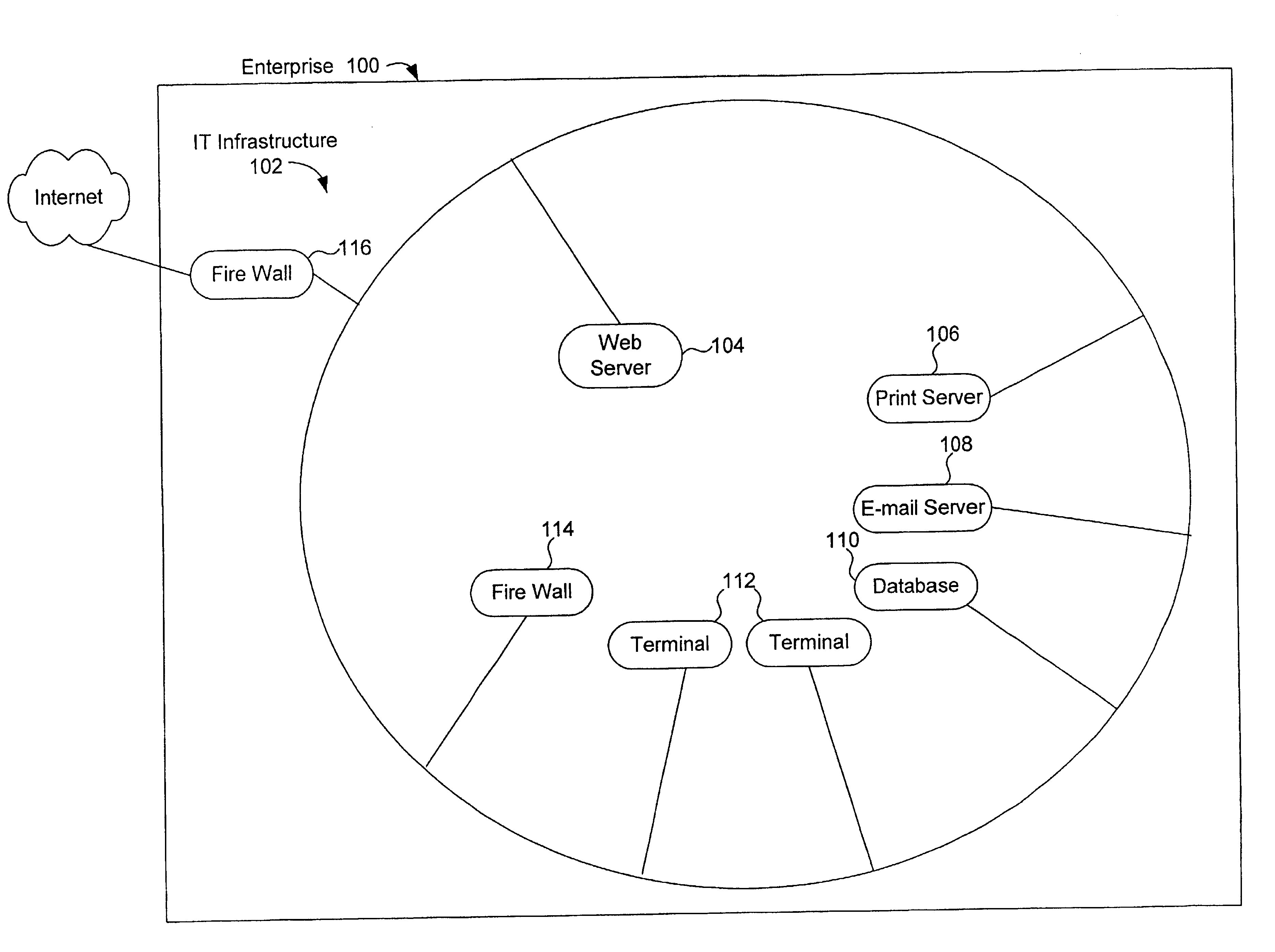

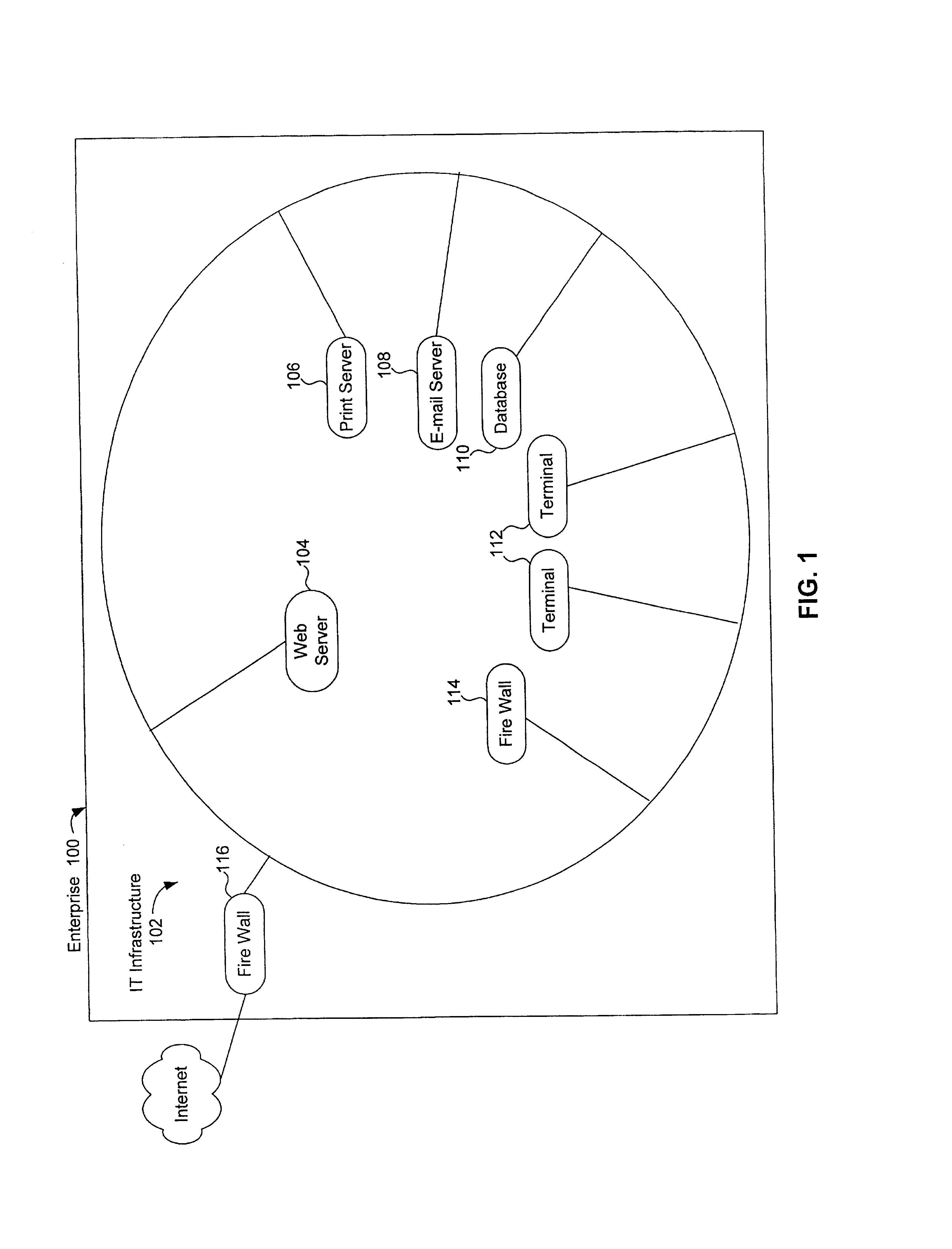

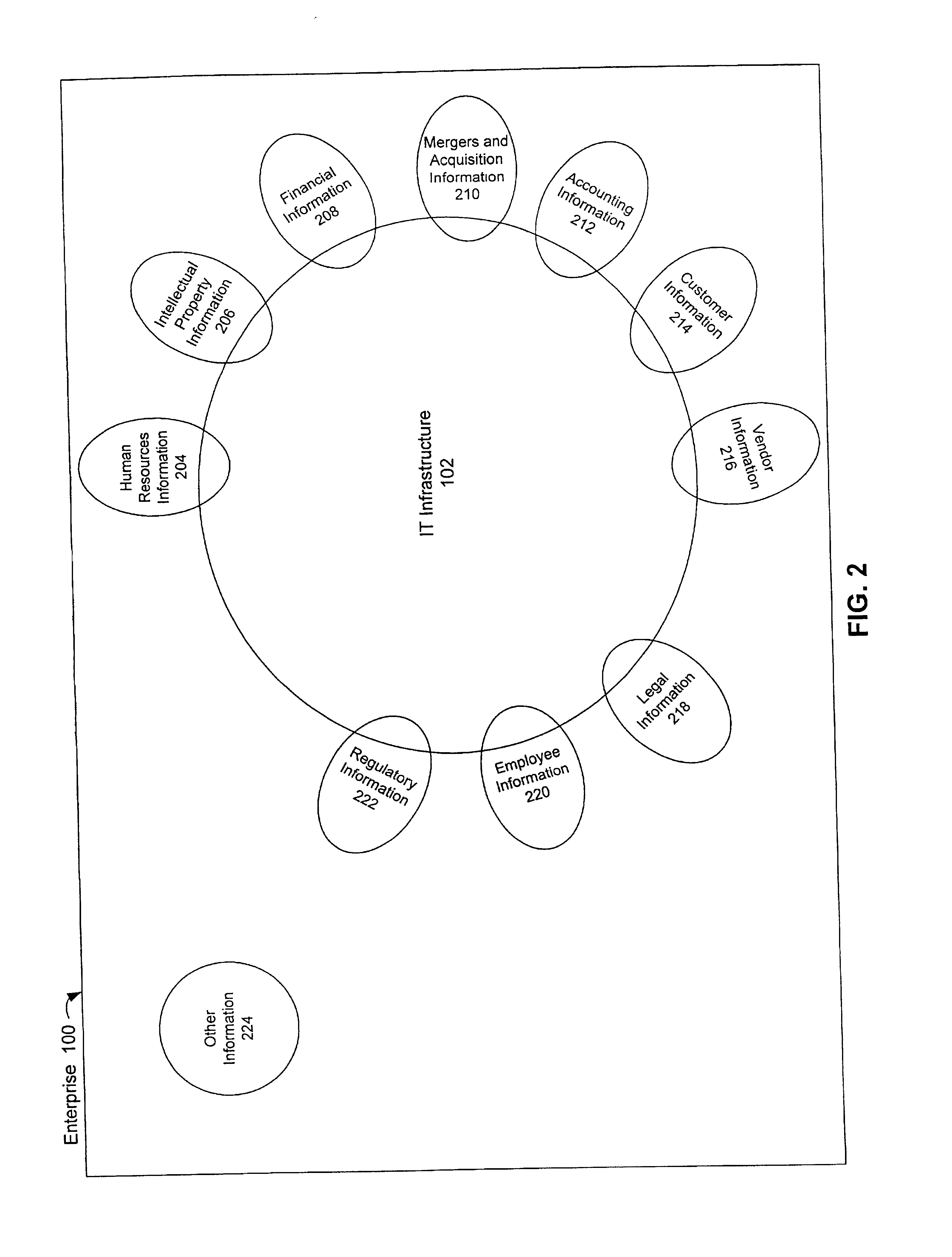

Method, system and computer program product for assessing information security

A method, system and computer program product for assessing information security interviews users regarding technical and non-technical issues. In an embodiment, users are interviewed based on areas of expertise. In an embodiment, information security assessments are performed on domains within an enterprise, the results of which are rolled-up to perform an information security assessment across the enterprise. The invention optionally includes application specific questions and vulnerabilities and / or industry specific questions and vulnerabilities. The invention optionally permits users to query a repository of expert knowledge. The invention optionally provides users with working aids. The invention optionally permits users to execute third party testing / diagnostic applications. The invention, optionally combines results of executed third party testing / diagnostic applications with user responses to interview questions, to assess information security. A system in accordance with the invention includes an inference engine, which may include a logic based inference engine, a knowledge based inference engine, and / or an artificial intelligence inference engine. In an embodiment, the invention includes an application specific tailoring tool that allows a user to tailor the system to assess security of information handled by a third party application program.

Owner:SAFEOPERATIONS

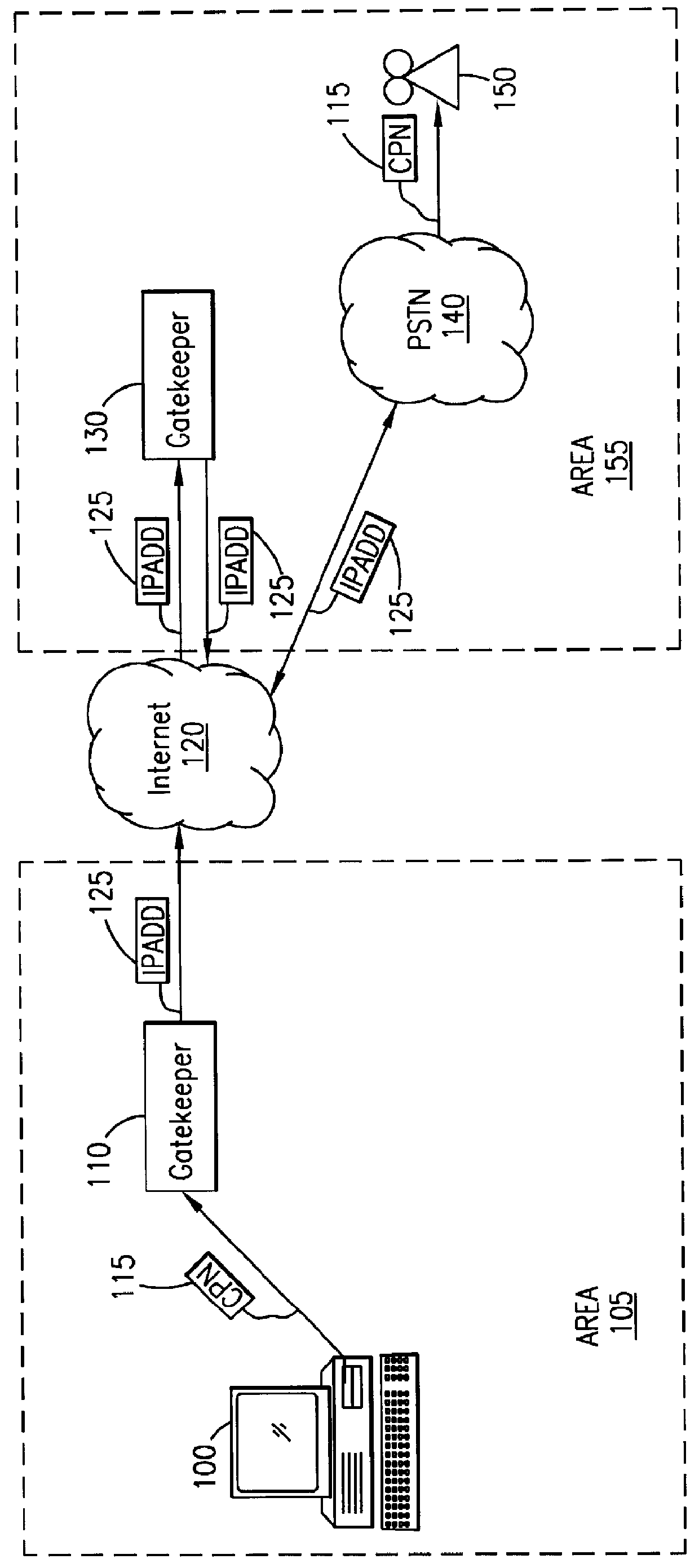

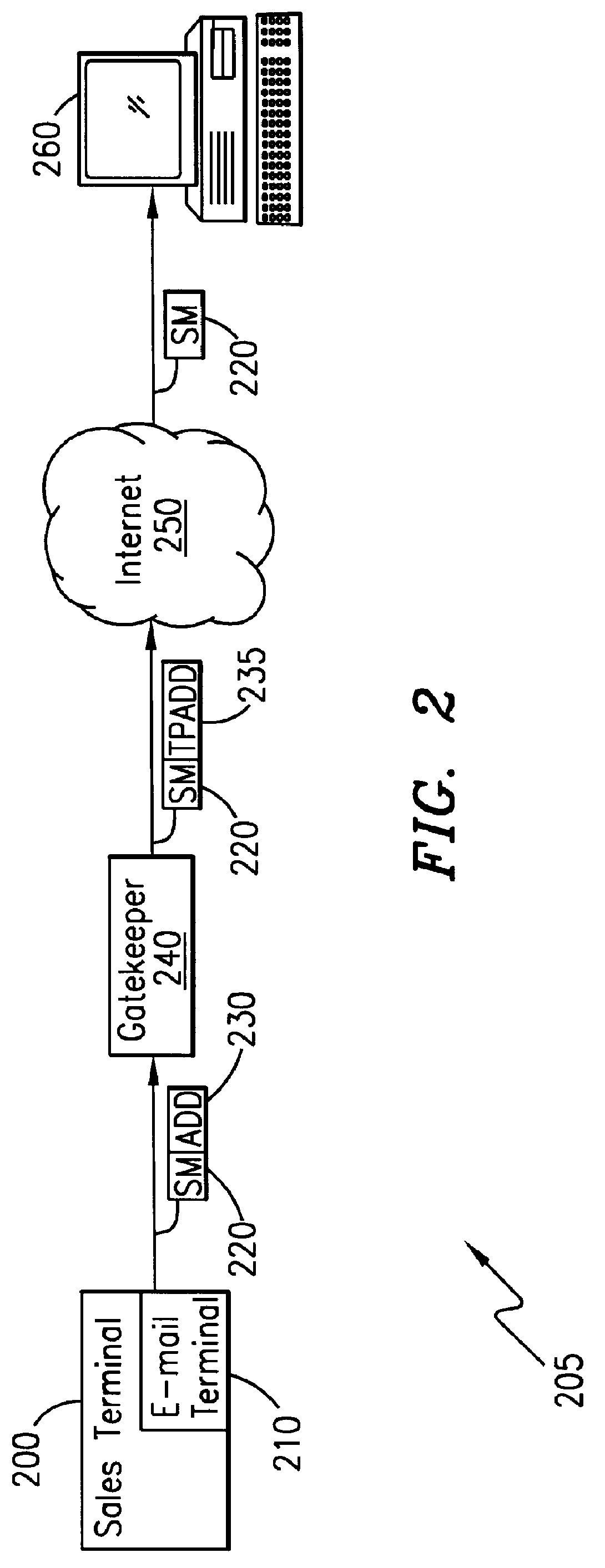

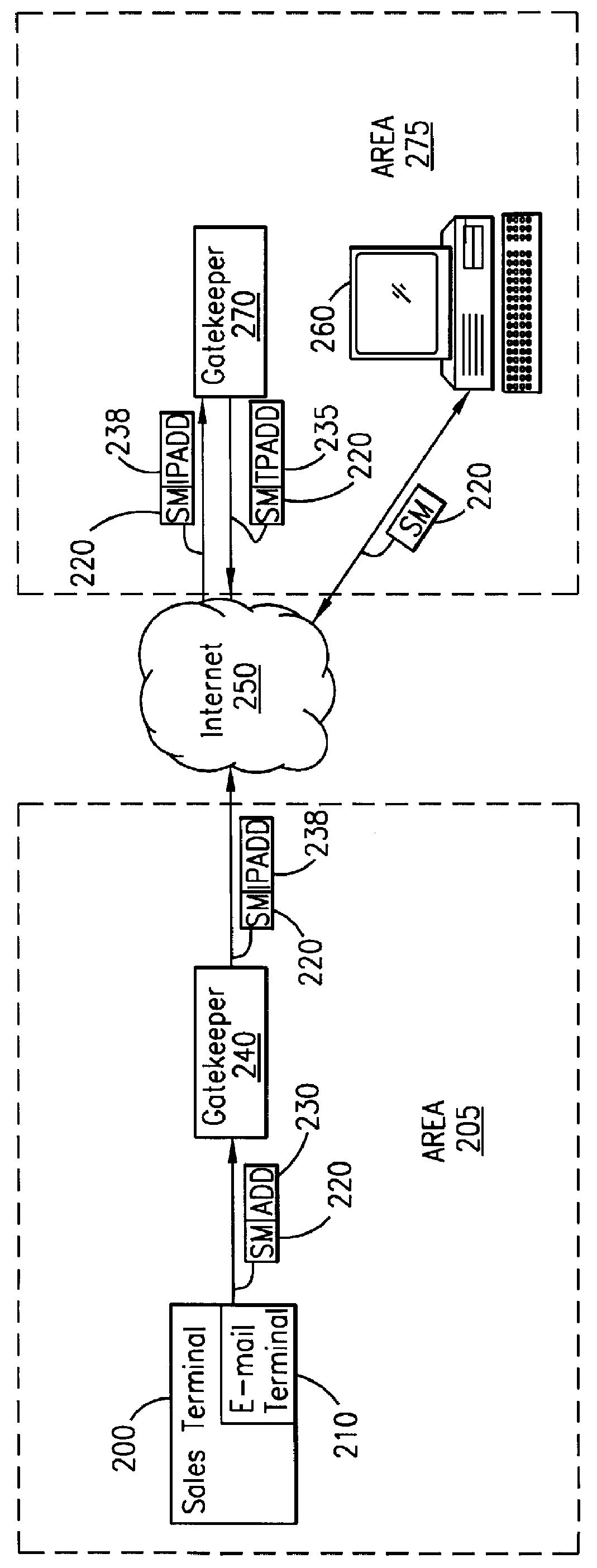

System and method for sending a short message containing purchase information to a destination terminal

InactiveUS6067529AEfficient and cost-effectiveReliable deliveryComplete banking machinesCash registersMulticast addressComputer terminal

A telecommunications system and method is disclosed for providing a substantially immediate electronic receipt after a consumer has made a purchase. When a consumer makes a purchase, the sales terminal, which is attached with a short message / e-mail sending capable terminal, can generate and route a short message along with the detailed purchase information to a transport address or alias address associated with the consumer via a Gatekeeper for the Internet for the area that the sales terminal is located in. Upon receipt of the short message, the Gatekeeper can then convert the alias address to the transport address, if the alias address is given and the consumer does not want the short message sent to the alias address, and forward the short message through the Internet to that transport address (or alias address) as an Internet Protocol datagram for storage and retrieval of the short message by the consumer either immediately or at a later time.

Owner:ERICSSON INC

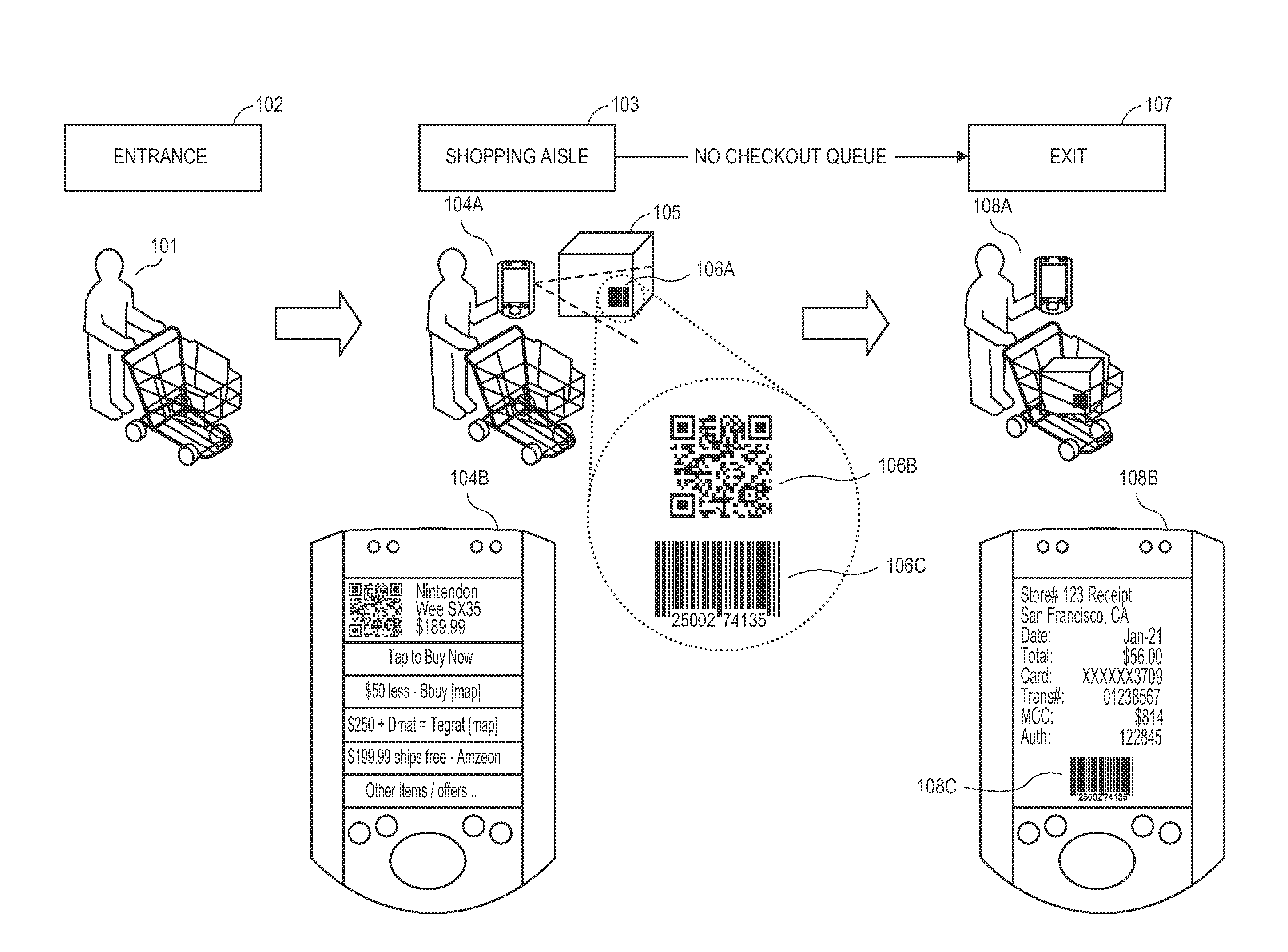

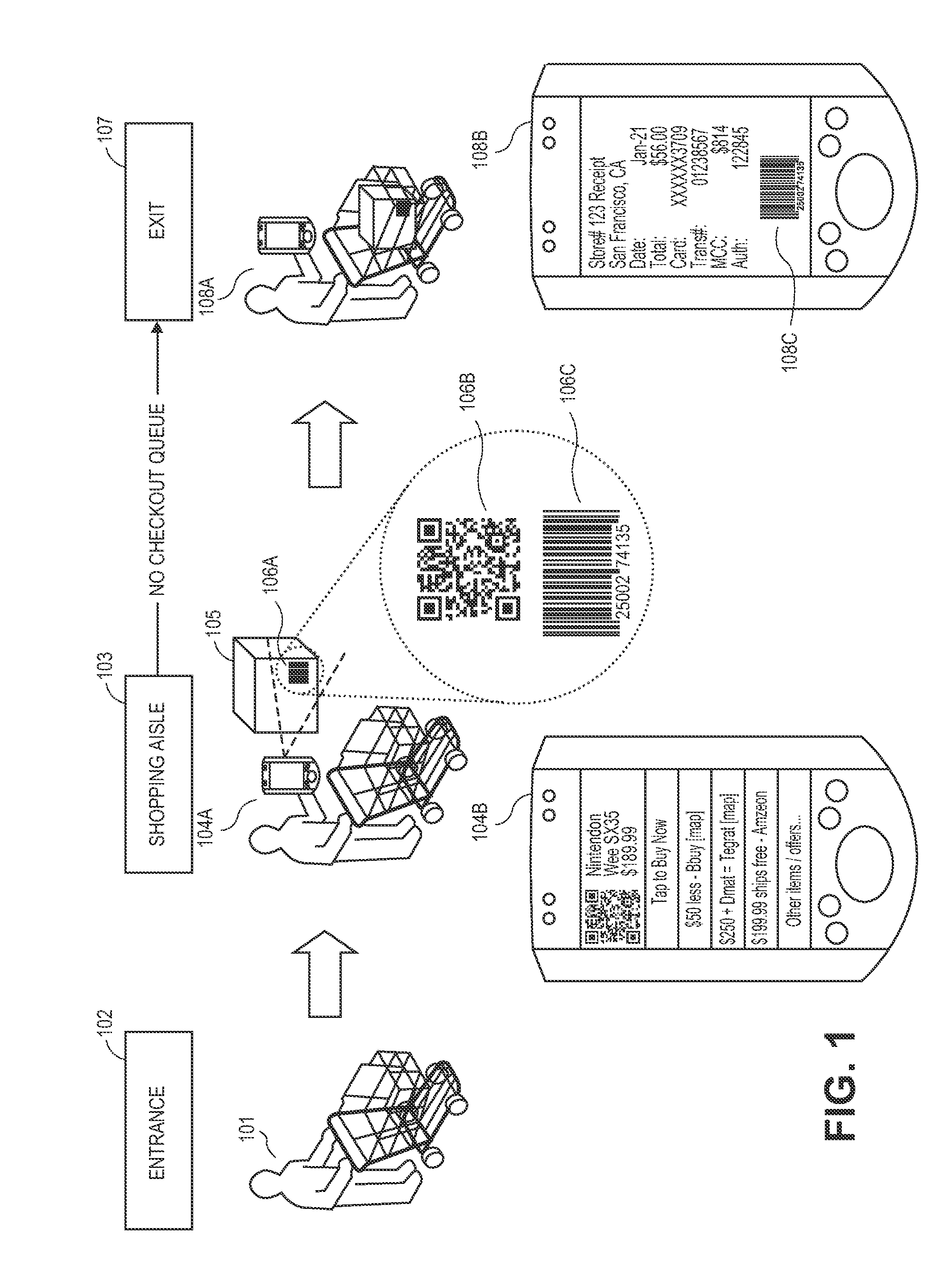

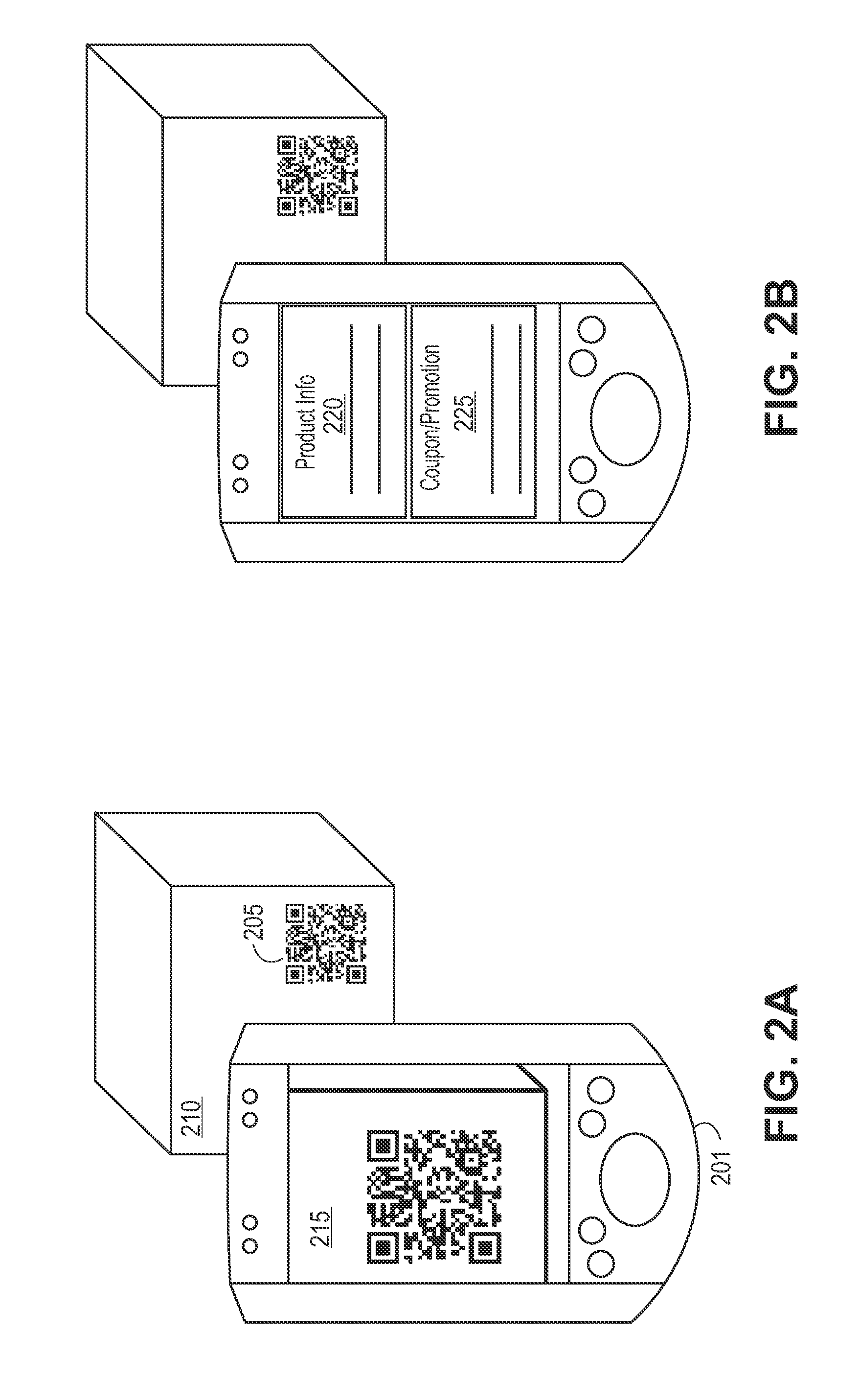

In-person one-tap purchasing apparatuses, methods and systems

Methods, systems, and devices are disclosed for transforming product code snapshots into real-time, offer-driven electronic purchase transaction notifications that minimize fraud. In one embodiment, a smart phone scans a product identifier from a product package, a server accesses a products database for product purchase offers associated with the product identifier, a user authorizes a credit card from his or her wallet to charge, and then product purchase offers or other credit card offers (for loyalty points or otherwise) are provided to the user mobile device. After a user has purchased an item while in the aisle of the store, the user's smart phone displays a barcoded electronic receipt that can be scanned by the exit so that the consumer can walk out with the produce. In some embodiments, a video chat is requested by a customer service representative and a transaction risk score is lowered based on acceptance of the video chat.

Owner:VISA INT SERVICE ASSOC

Method And Apparatus For Completing A Transaction Using A Wireless Mobile Communication Channel And Another Communication Channel

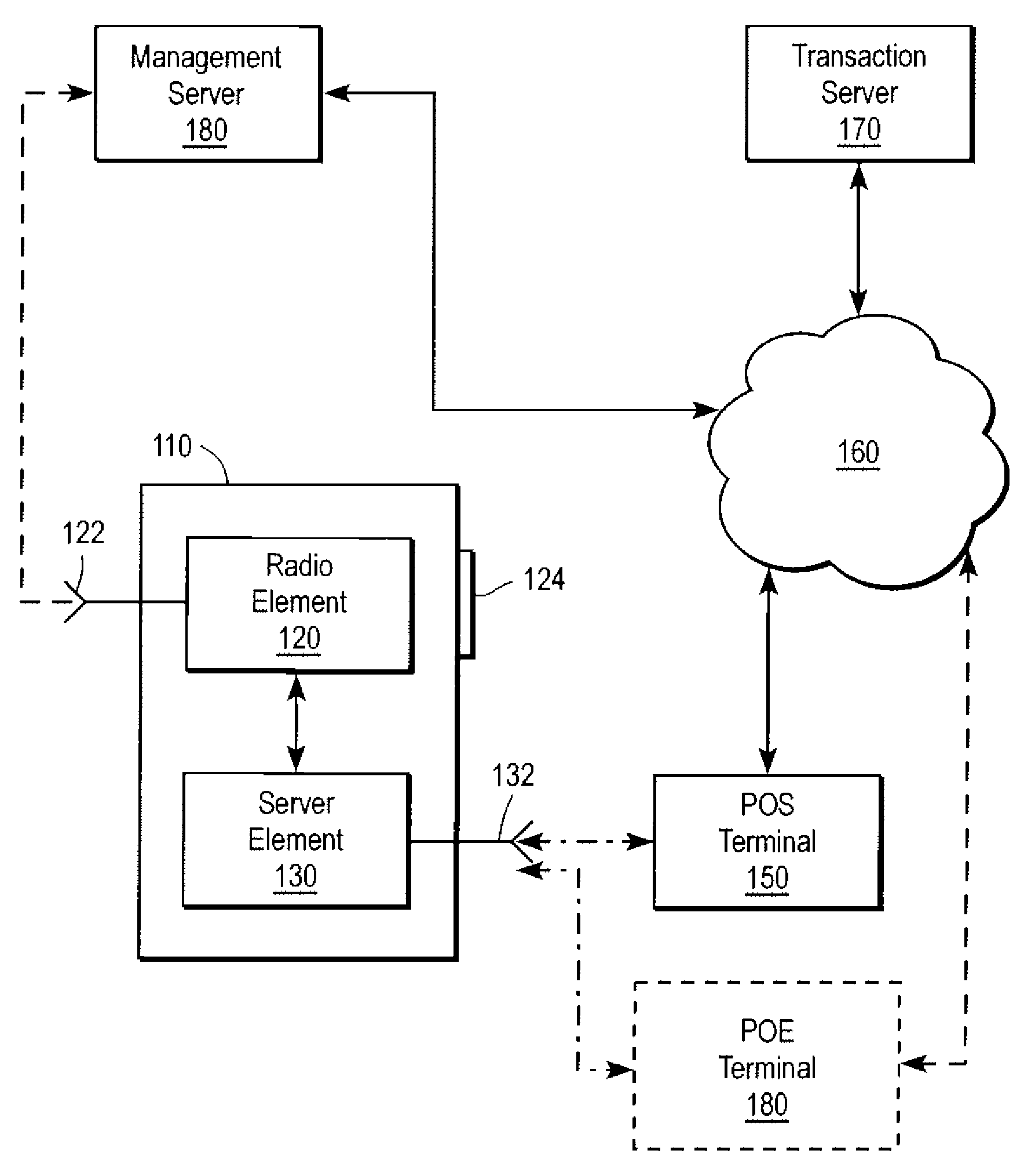

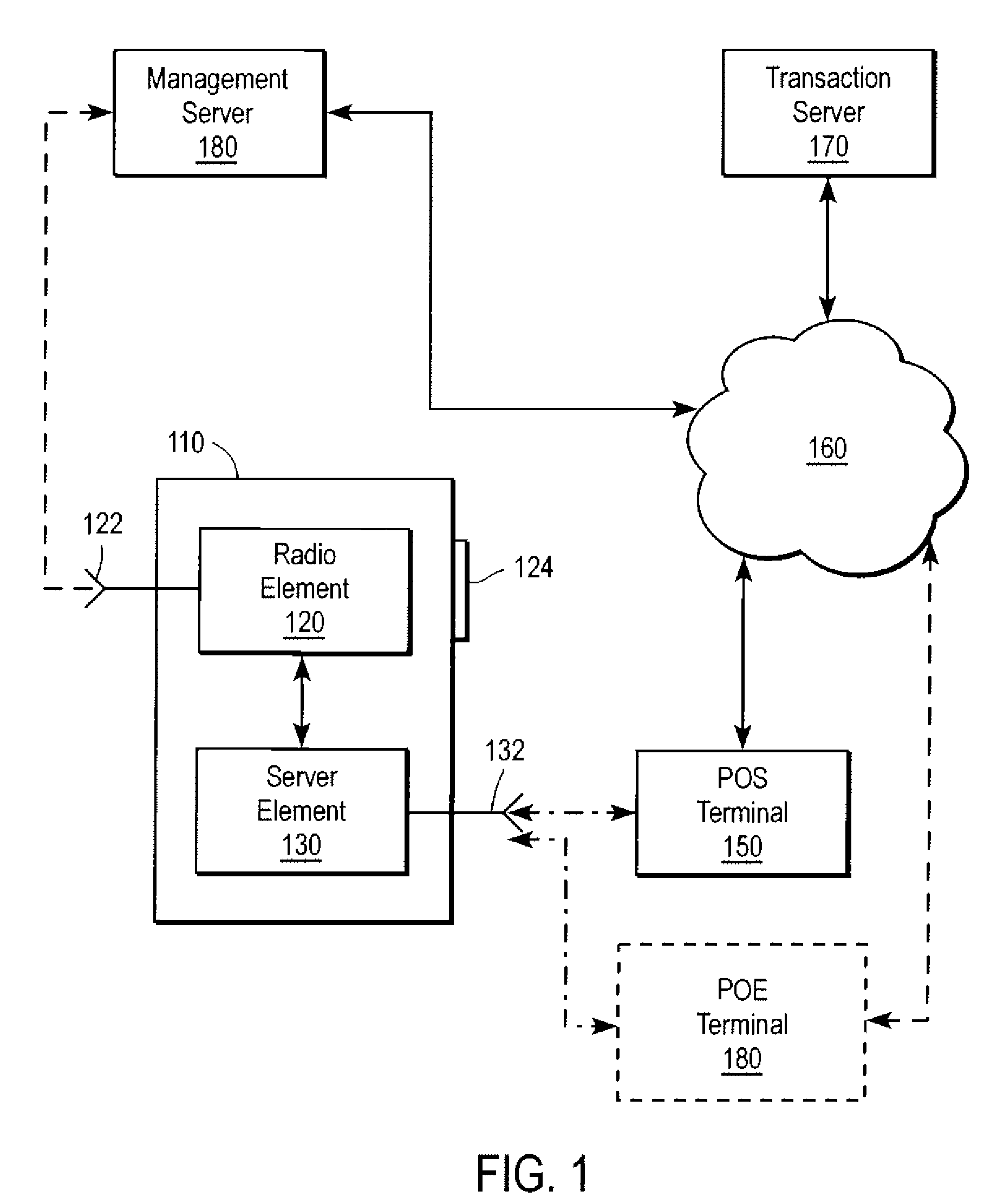

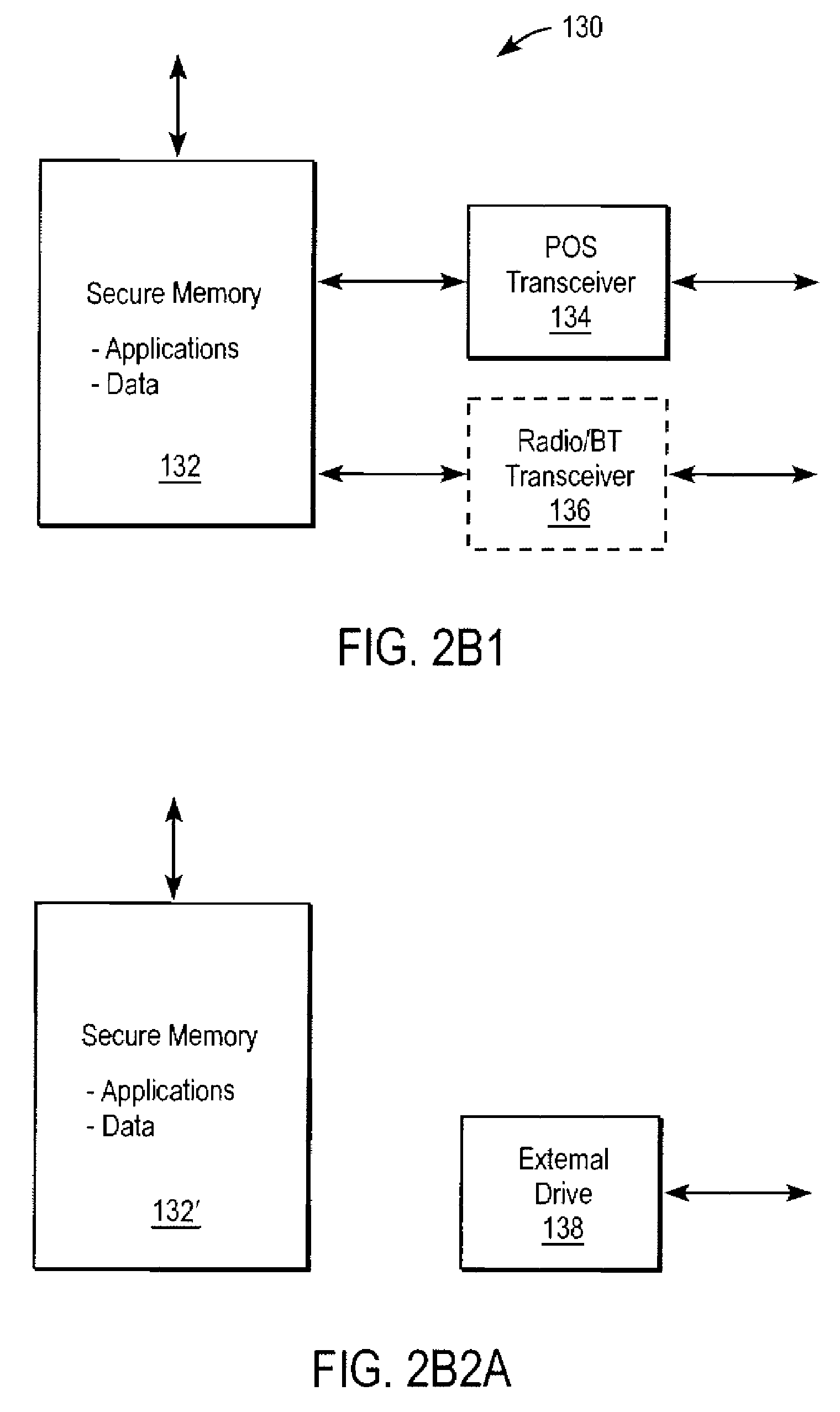

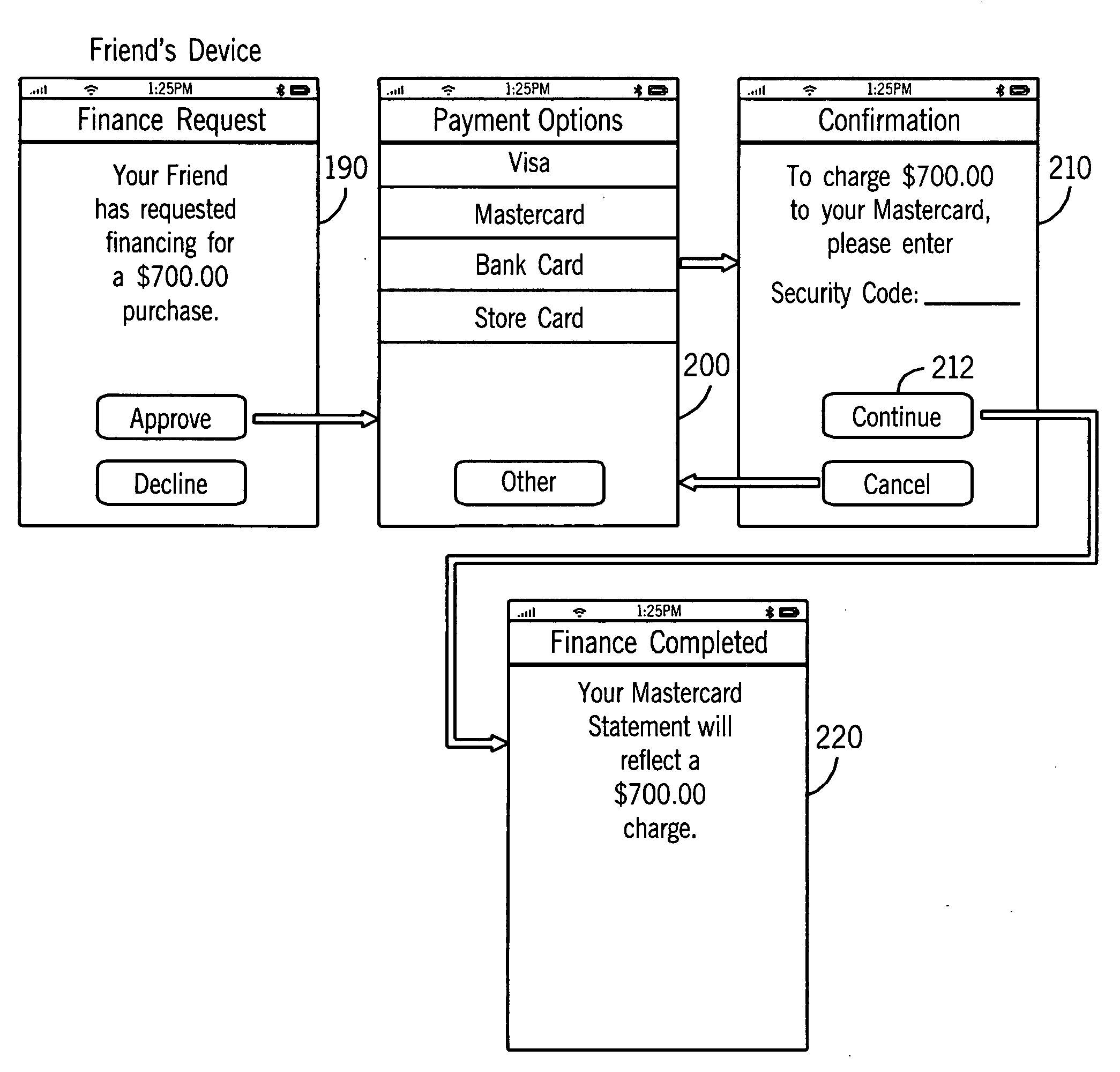

The present invention provides a method and apparatus for completing a transaction using a wireless mobile communication channel and another communication channel, particularly another communication channel that provides for near field radio channels (NFC), as well as other communication channels, such as Bluetooth or WIFI. The present invention also provides a method of completing a transaction in which a management server assists a transaction server and a point of sale terminal in forwarding transaction information to a hand-held mobile device, with the transaction having originated from the hand-held mobile device. There is also provided a hand-held mobile device that wirelessly communicates between a secure element and a radio element that are associated with the hand-held mobile device.

Owner:FISHER MICHELLE

Smart menu options

InactiveUS20100082445A1Maximize the benefitsHand manipulated computer devicesFinanceContext basedHuman–computer interaction

Systems and methods are provided that allow for a portable electronic device to provide smart menus to a user based on a context of a transaction. Specifically, the method of using a portable electronic device may include opening a near field communication (NFC) channel with a point-of-purchase device and providing a smart menu based on a determined context. The portable electronic device may be configured to determine the context based at least in part upon acquiring sales transaction information for the point-of-purchase device. Additionally, the portable electronic device may be configured to determine the context based at least in part upon acquiring vendor identification information.

Owner:APPLE INC

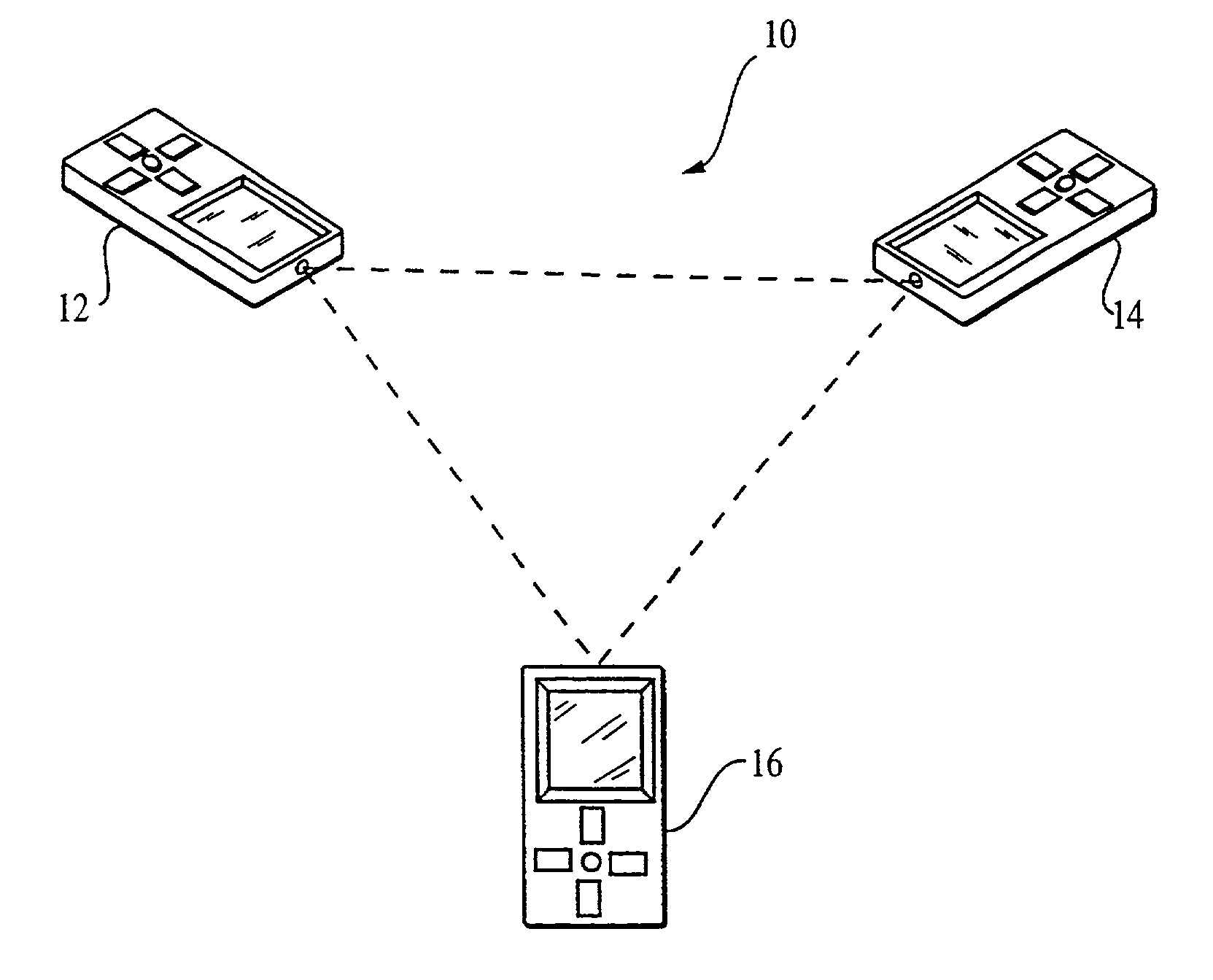

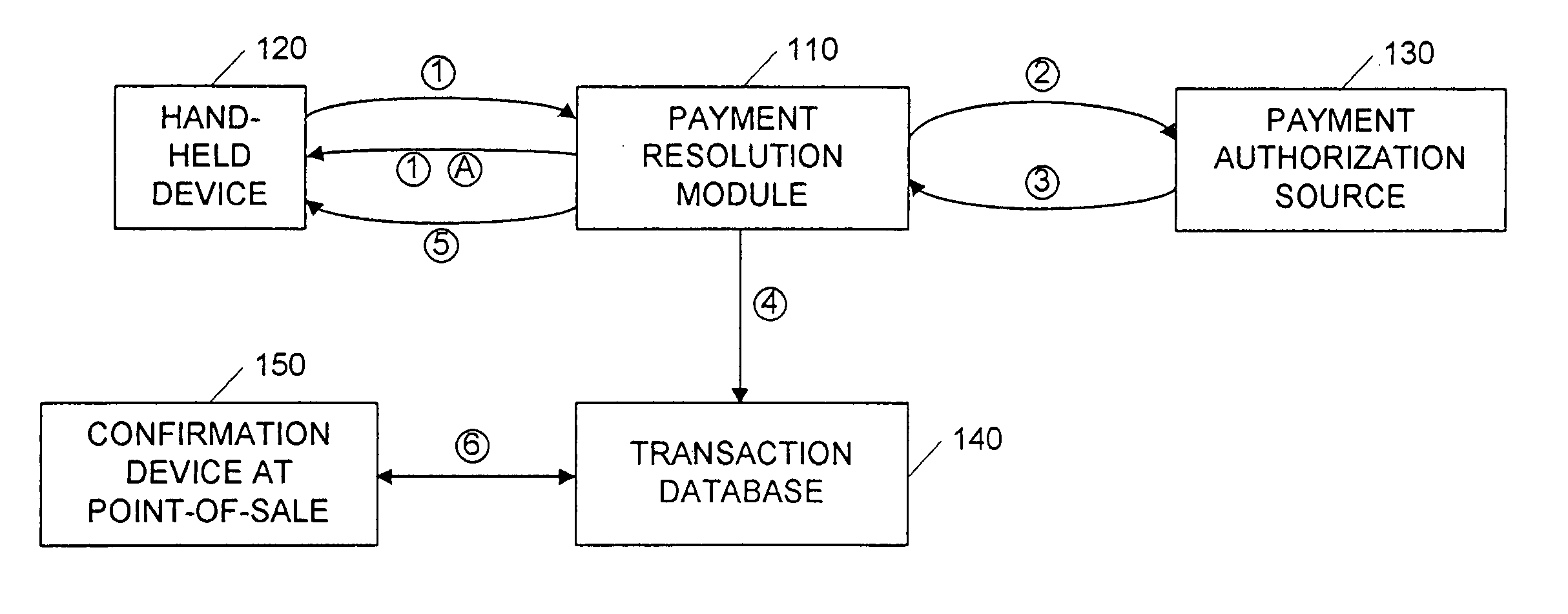

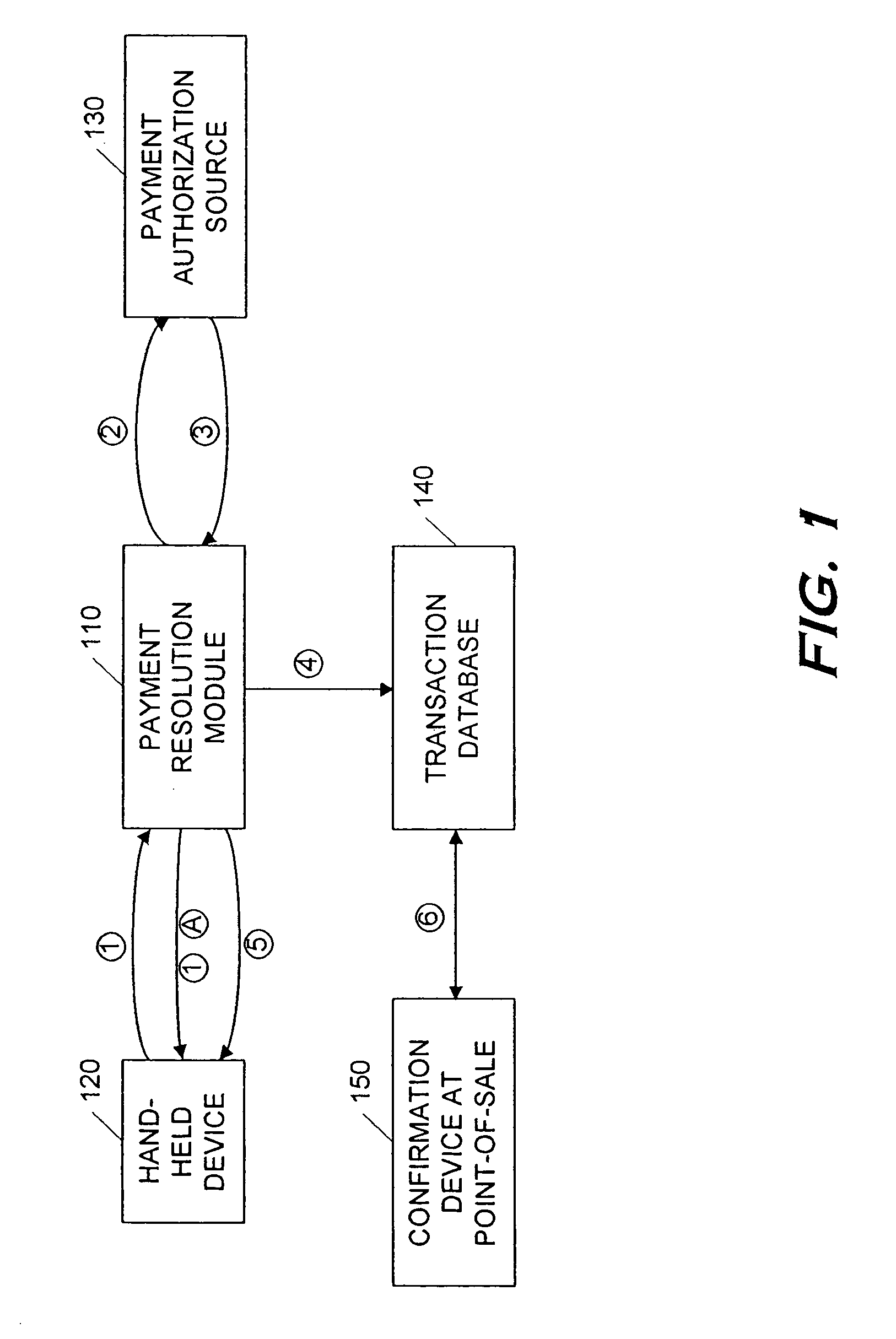

Secure money transfer between hand-held devices

A payment resolution module is configured to communicate with hand-held devices (such as mobile phones, PDA's, or computers) to allow secure transfer of funds between financial accounts associated with each of the hand-held devices. A user of a paying device may be identified as the owner of the device either by having the option to enter a personal identification code, or by using a biometric to identify himself, for example. Accordingly, only an authorized user of the hand-held device may use the hand-held device to transfer funds. A user of the recipient device may be identified by an identification code or a telephone number, for example, which is associated with a recipient financial account. After the payment resolution module receives authorization for a payment request to the recipient account, a payment transfer module transmits the requested amount from a payment source associated with the identified owner of the paying device to the recipient account.

Owner:XILIDEV

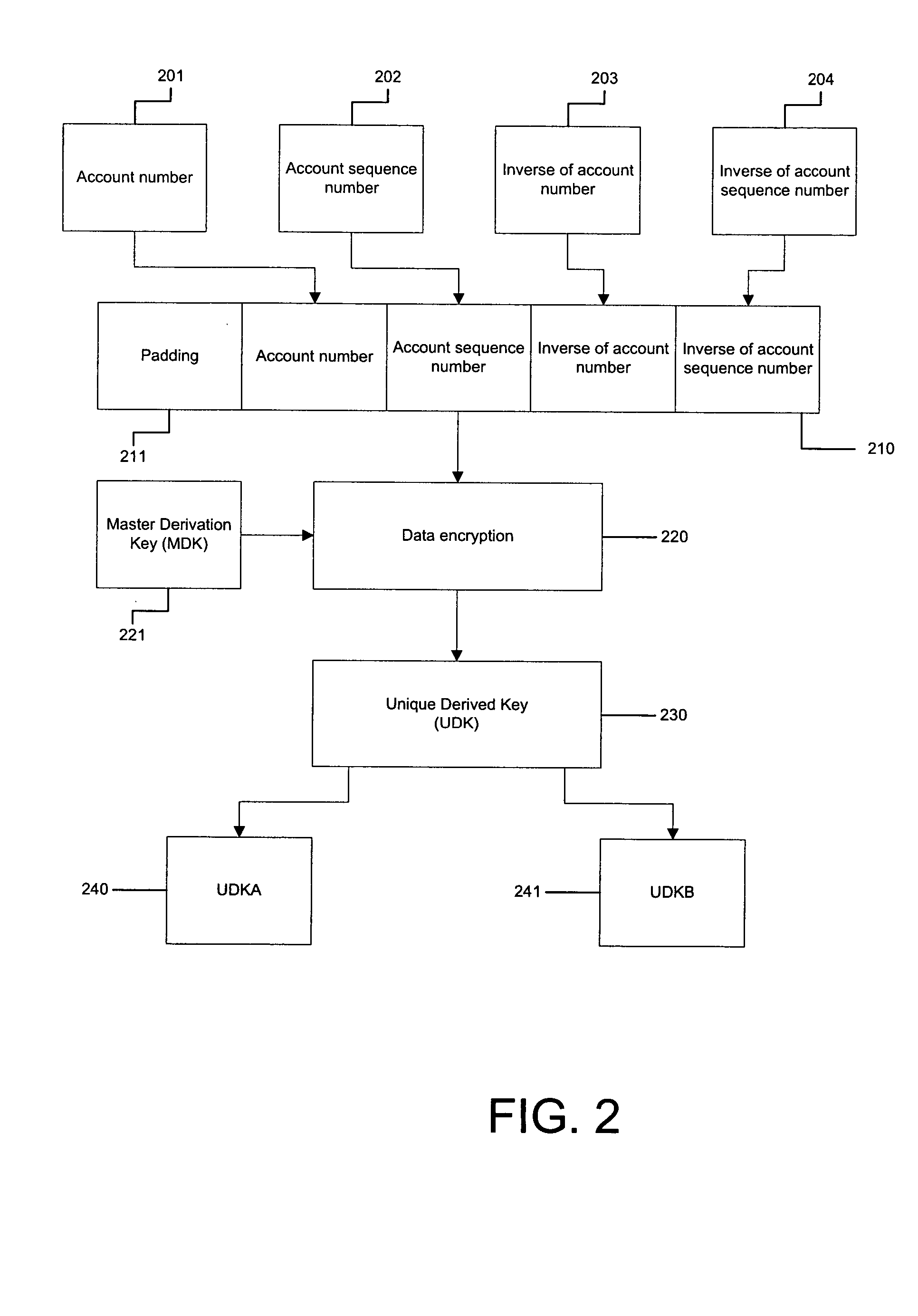

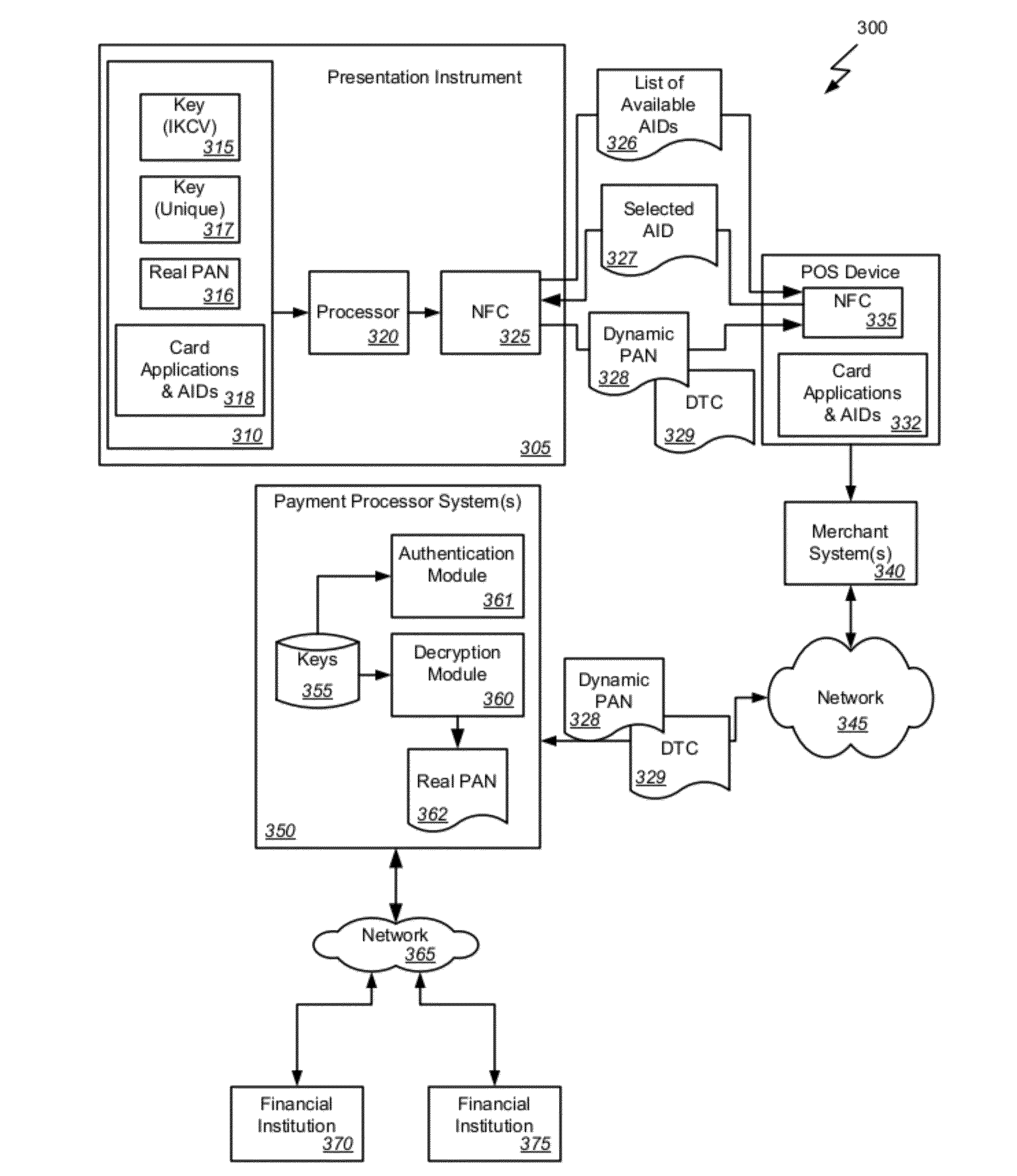

Processing transactions with an extended application id and dynamic cryptograms

Methods, systems, and machine-readable media are disclosed for handling information related to a transaction conducted with a presentation instrument at a POS device. Extended application IDs and dynamic cryptograms are use for the transaction. According to one embodiment, a method of processing a financial transaction for an account having a primary account number (PAN) can comprise detecting initiation of the transaction with the presentation instrument, and providing from the presentation instrument to the POS device a list of one or more applications IDs. Each application ID identifies an application that can be used to communicate data concerning the transaction between the presentation instrument and the POS device. The POS device selects one of the application IDs and returns it to the presentation instrument. Under the control of the selected application, the presentation instrument generates a Dynamic Transaction Cryptogram (DTC) and a dynamic PAN that are each valid for only a single transaction.

Owner:FIRST DATA

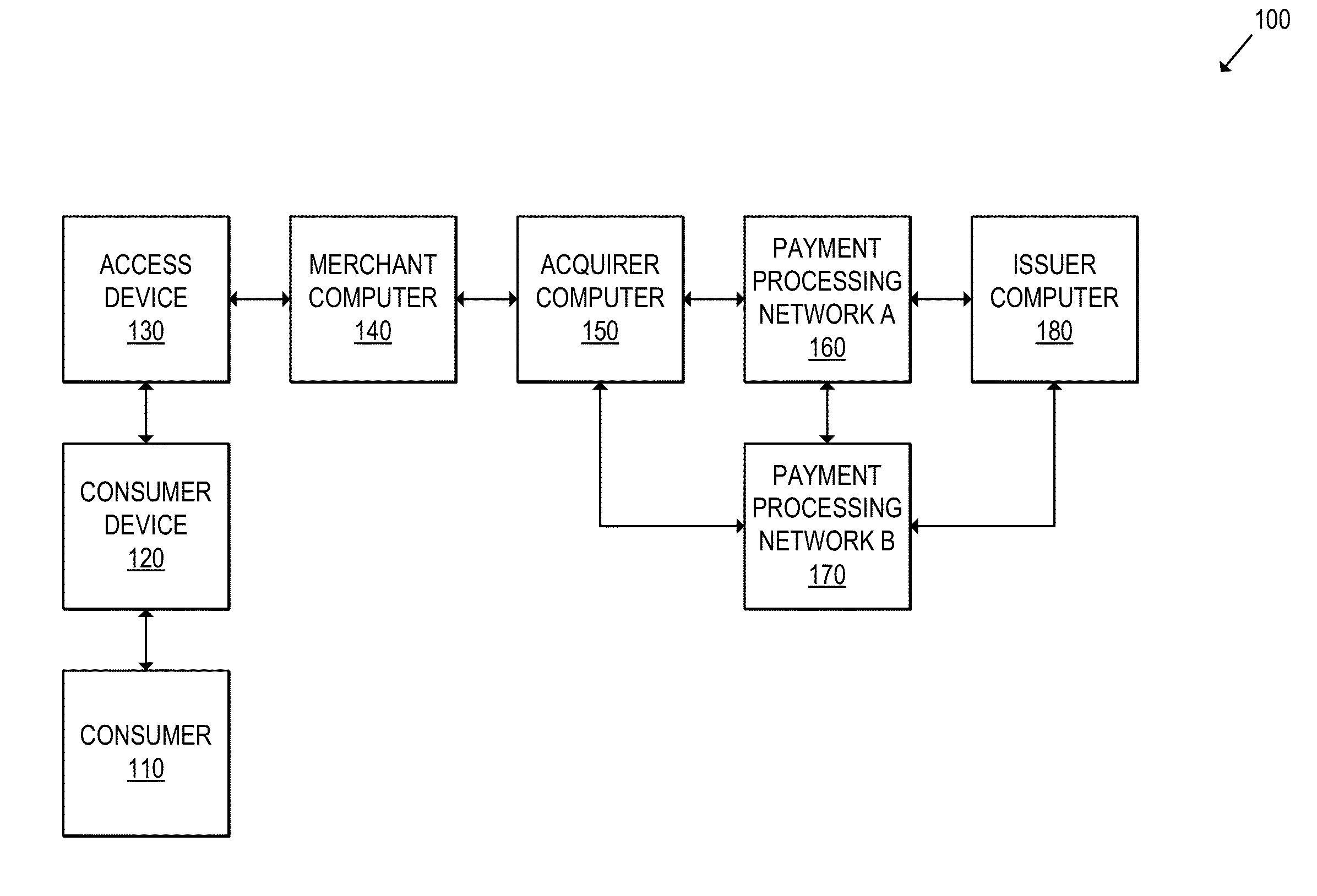

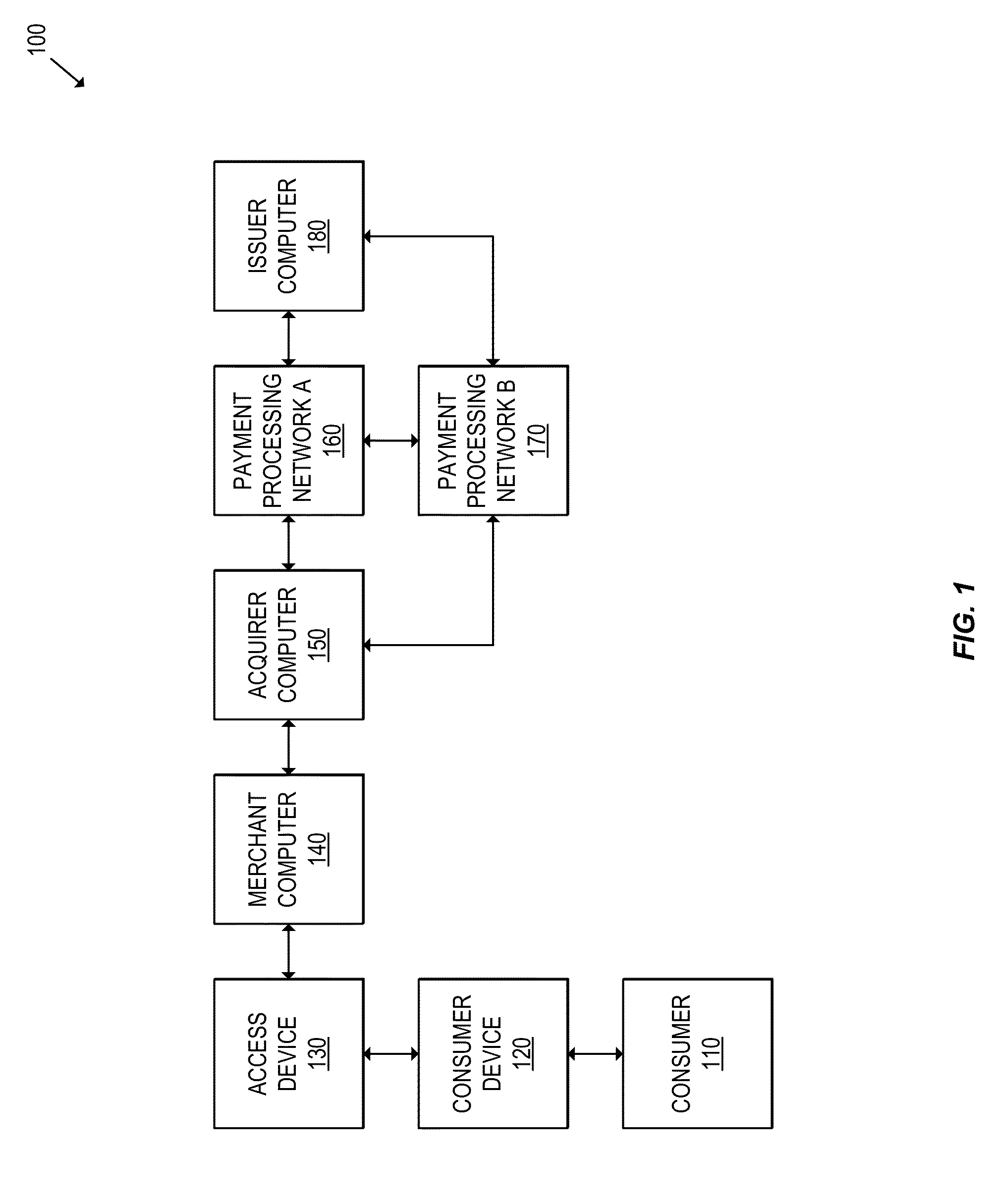

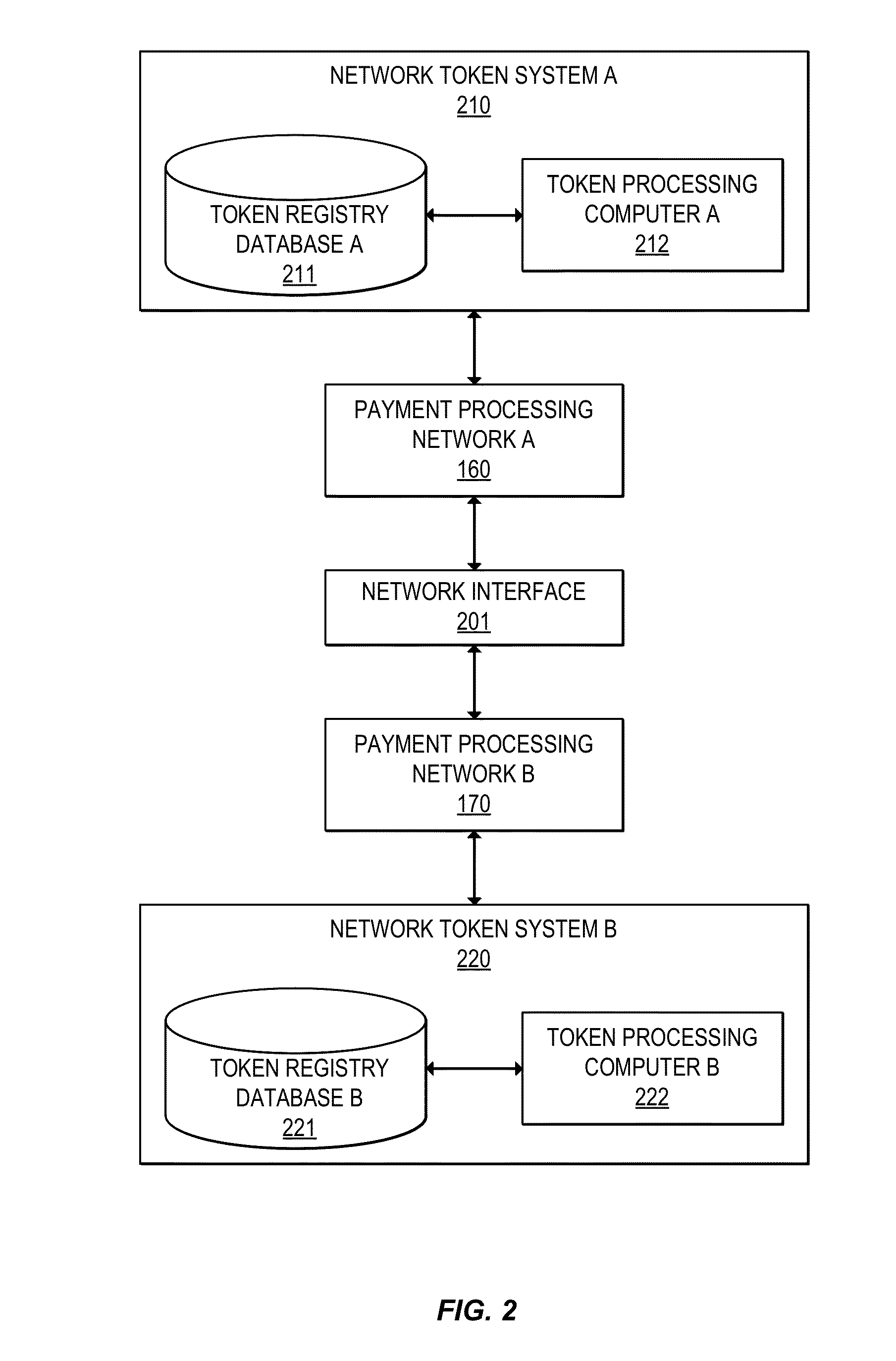

Multi-network tokenization processing

Systems, apparatuses, and methods are provided for enabling a transaction using a token associated with a first payment network to be conducted using a second payment network. When a transaction using a token is submitted to a payment network, the payment network can determine the payment network associated with the token. If the token is associated with a second payment network, a token verification request including the token can be sent to the second payment network. The second payment network can then return a token verification response including a primary account identifier such as a primary account number (PAN) corresponding to the token and a validation result. The transaction may then be processed using the primary account identifier.

Owner:VISA INT SERVICE ASSOC

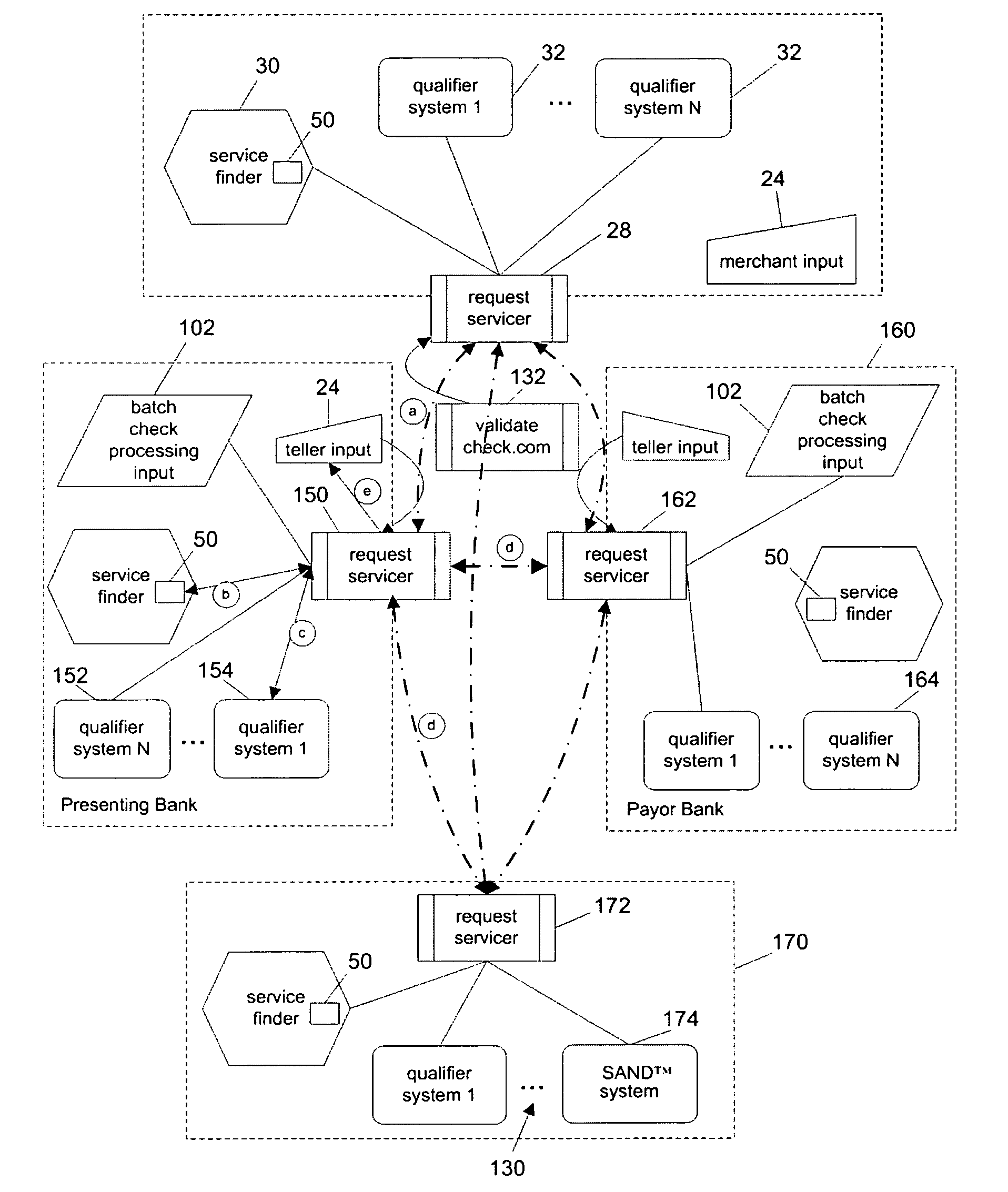

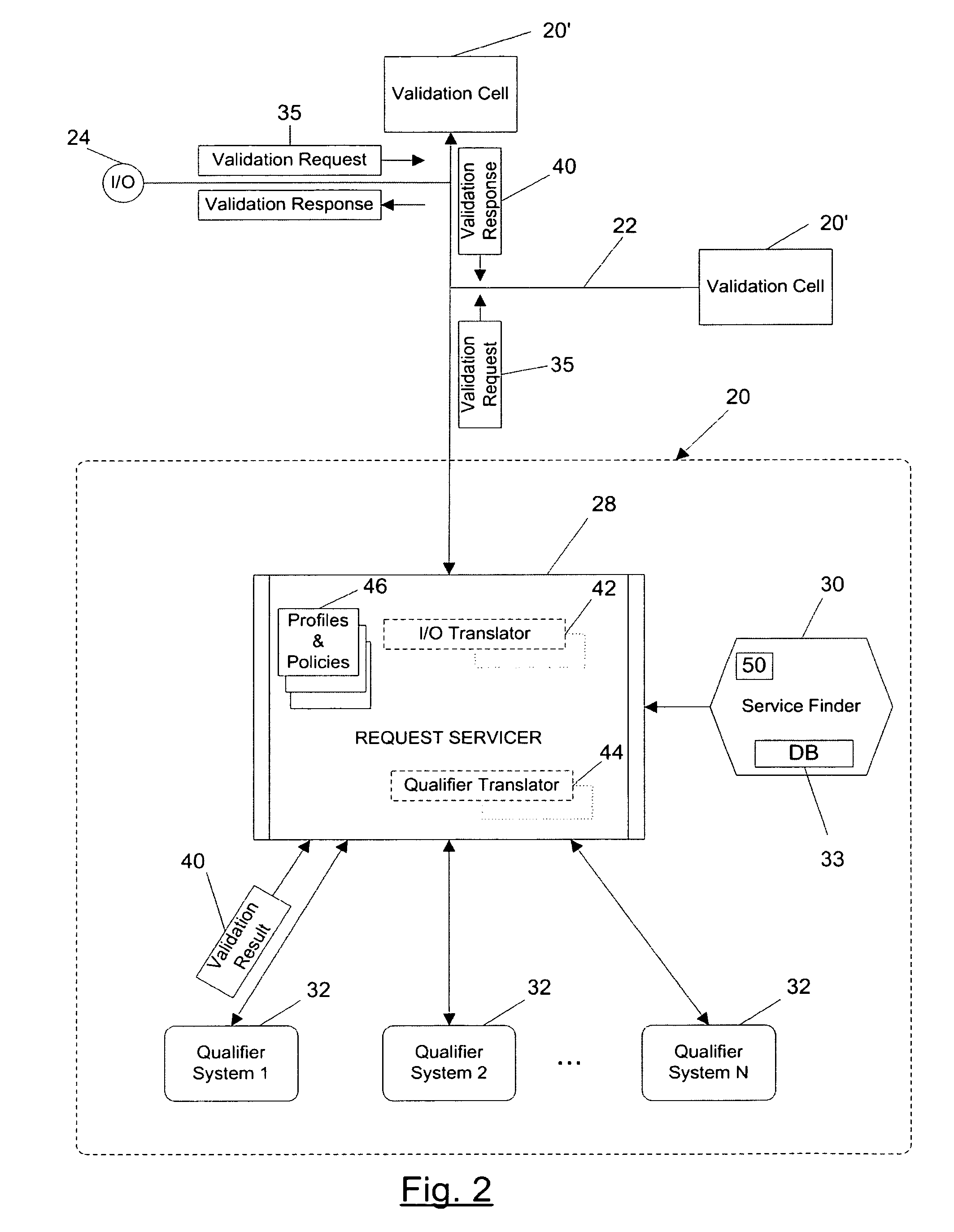

Payment validation network

ActiveUS7004382B2Easy to analyzeReduce riskComplete banking machinesSpecial service provision for substationPaymentTransaction data

A payment validation network having network of payment validation cells, each of which includes: one or more local qualifier systems for assessing the risk of loss in accepting a check; a service finder for identifying the scope of coverage provided by each of the local qualifier systems and for identifying the scope of coverage provided by other cells; and one or more input / output (I / O) sources for obtaining transaction data associated with a check at a point of presentment. The request servicer interfaces with the I / O sources, service finder and the qualifier systems in order to (i) receive transaction data from an I / O source in connection with the check, including the routing / transit number, (ii) maintain a user profile for the I / O source, (iii) consult the service finder to identify which local qualifier systems cover the routing / transit (R / T) number associated with the check, (iv) transmit a payment validation request to the identified local qualifier systems and at least one other remote request servicer in accordance with the user profile, (v) receive one or more validation results from local qualifier systems or remote request servicers, and (vi) process said results to provide a homogeneous validation assessment to the requesting I / O source.

Owner:ADVANCED SOFTWARE DESIGN

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com