Patents

Literature

476results about How to "Maximize the benefits" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

Smart menu options

InactiveUS20100082445A1Maximize the benefitsHand manipulated computer devicesFinanceContext basedHuman–computer interaction

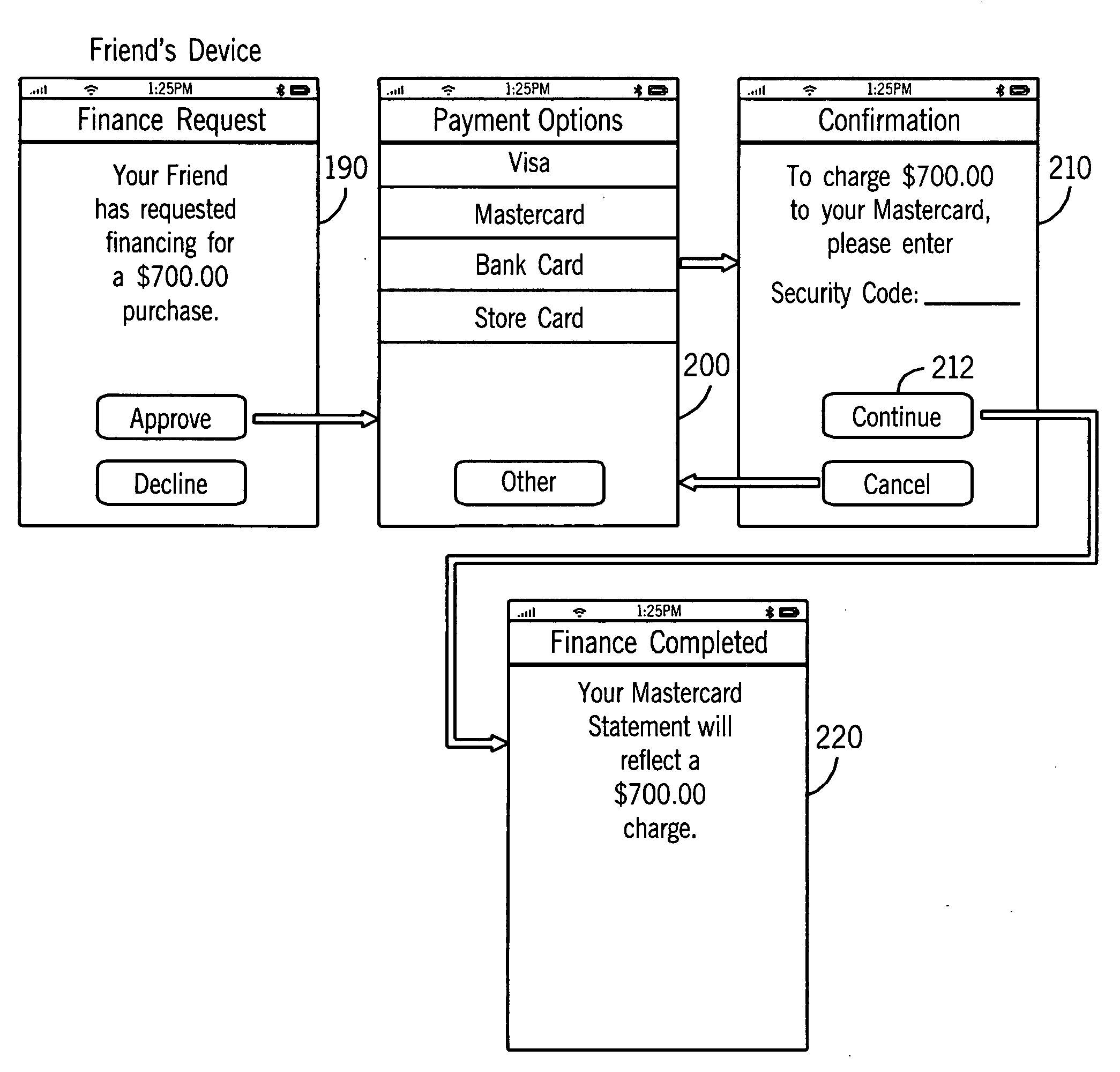

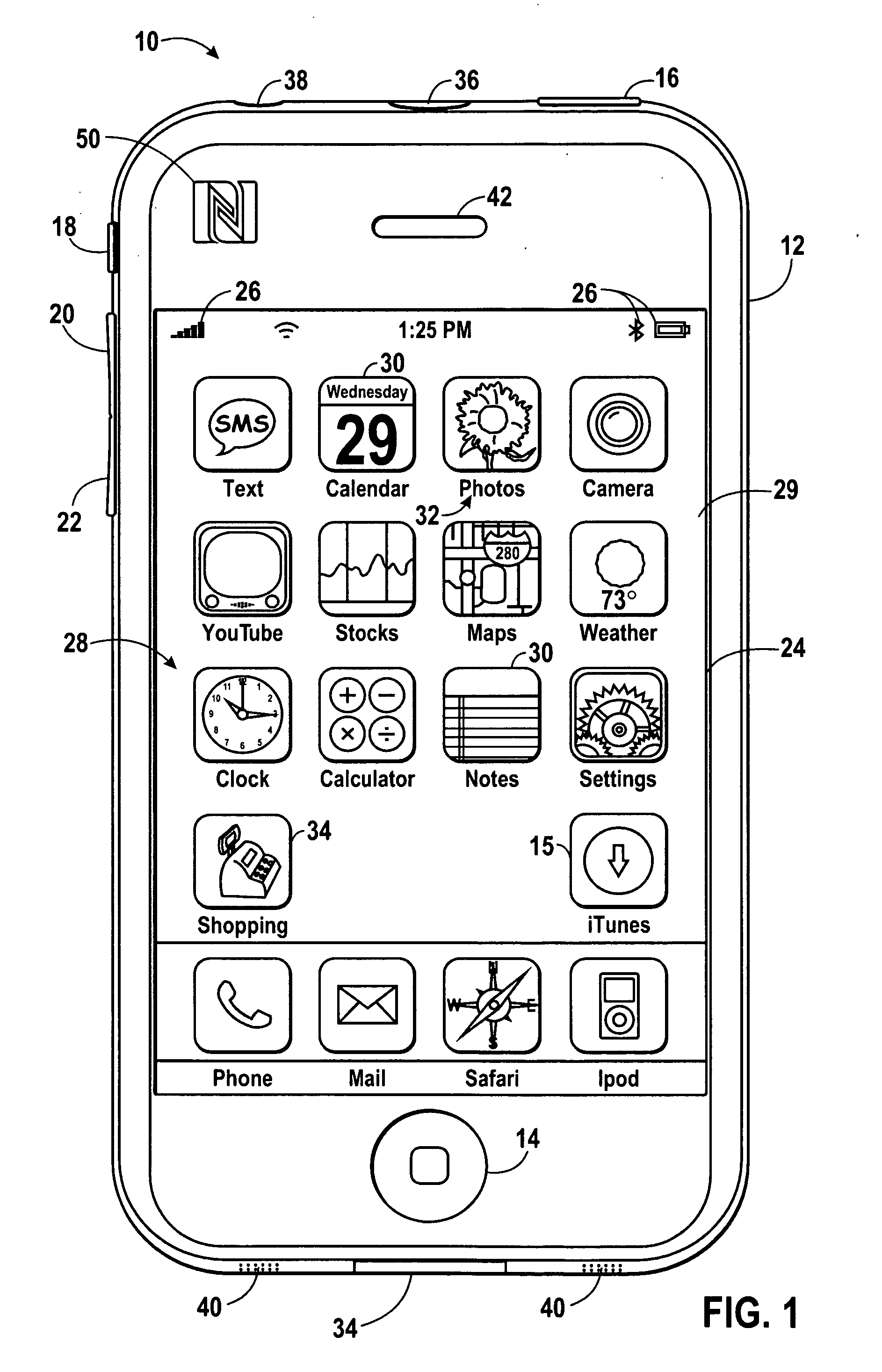

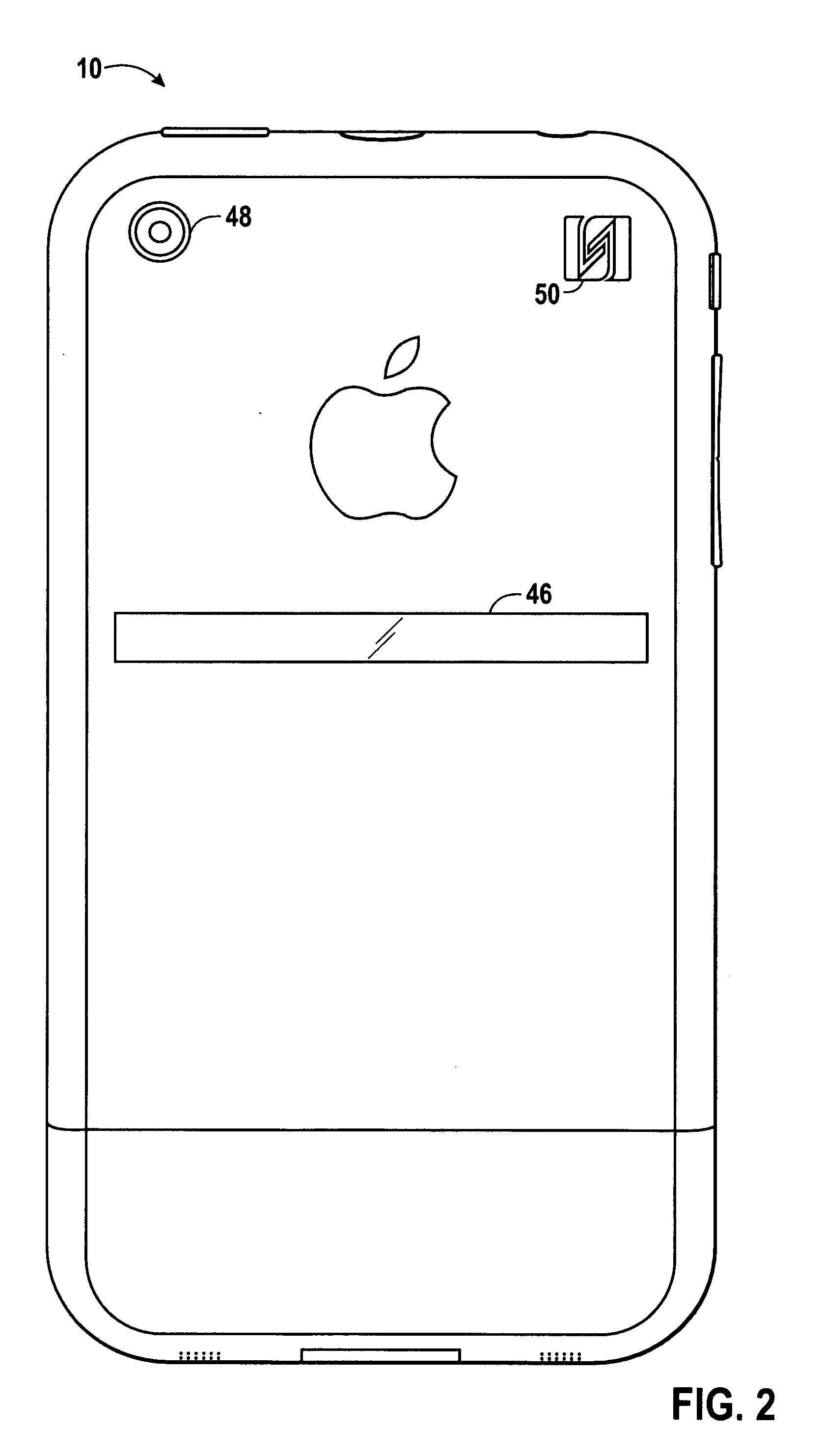

Systems and methods are provided that allow for a portable electronic device to provide smart menus to a user based on a context of a transaction. Specifically, the method of using a portable electronic device may include opening a near field communication (NFC) channel with a point-of-purchase device and providing a smart menu based on a determined context. The portable electronic device may be configured to determine the context based at least in part upon acquiring sales transaction information for the point-of-purchase device. Additionally, the portable electronic device may be configured to determine the context based at least in part upon acquiring vendor identification information.

Owner:APPLE INC

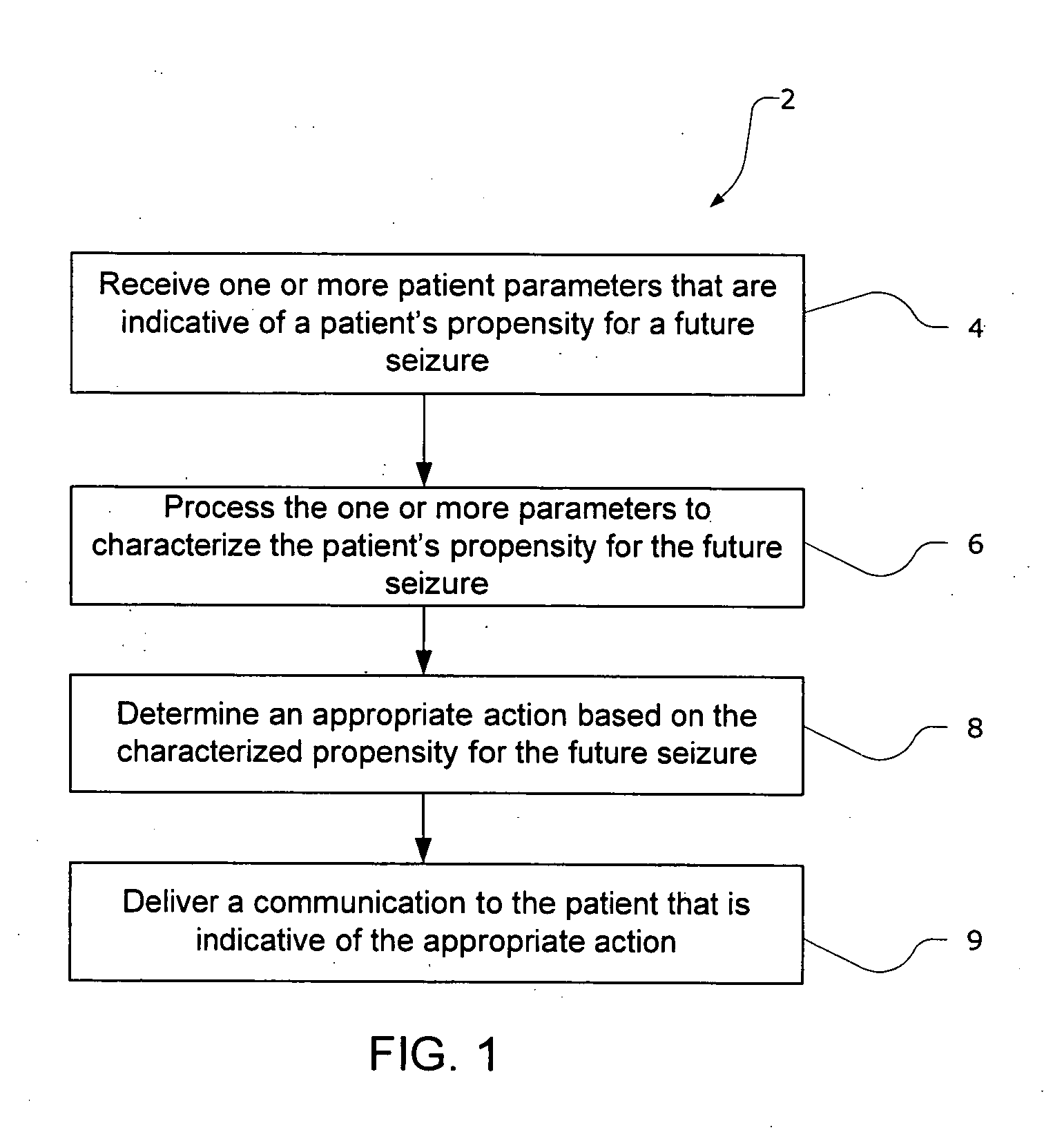

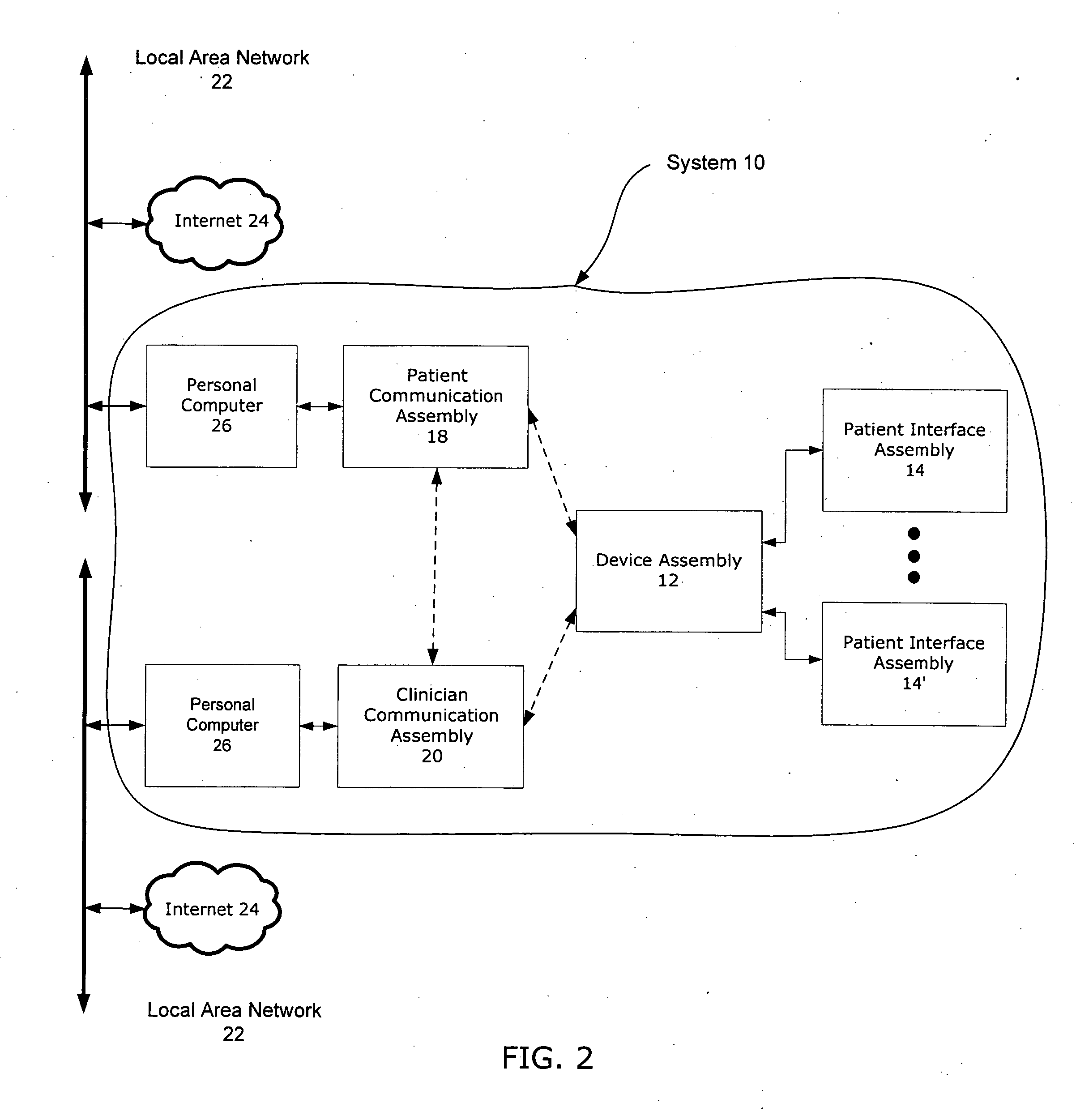

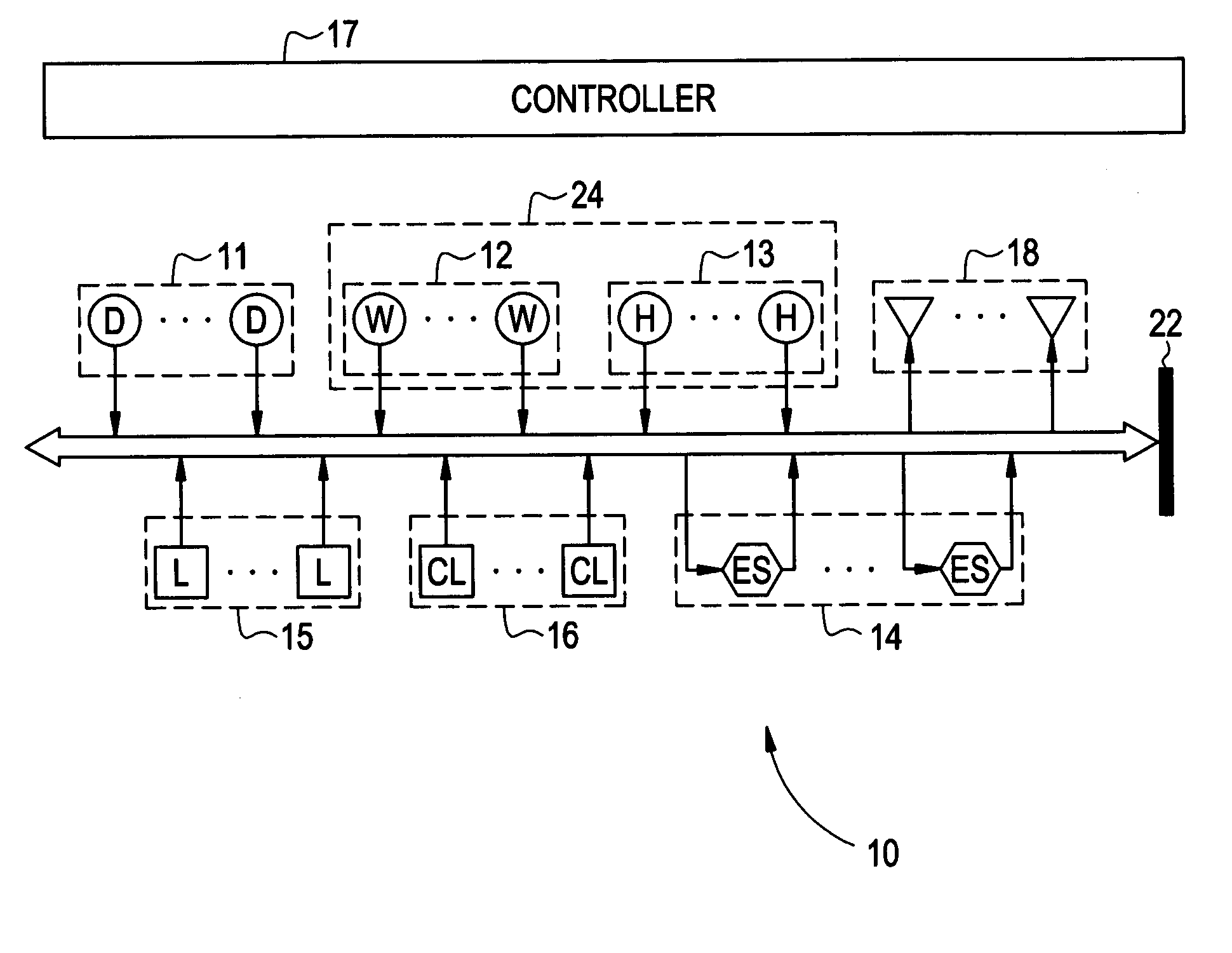

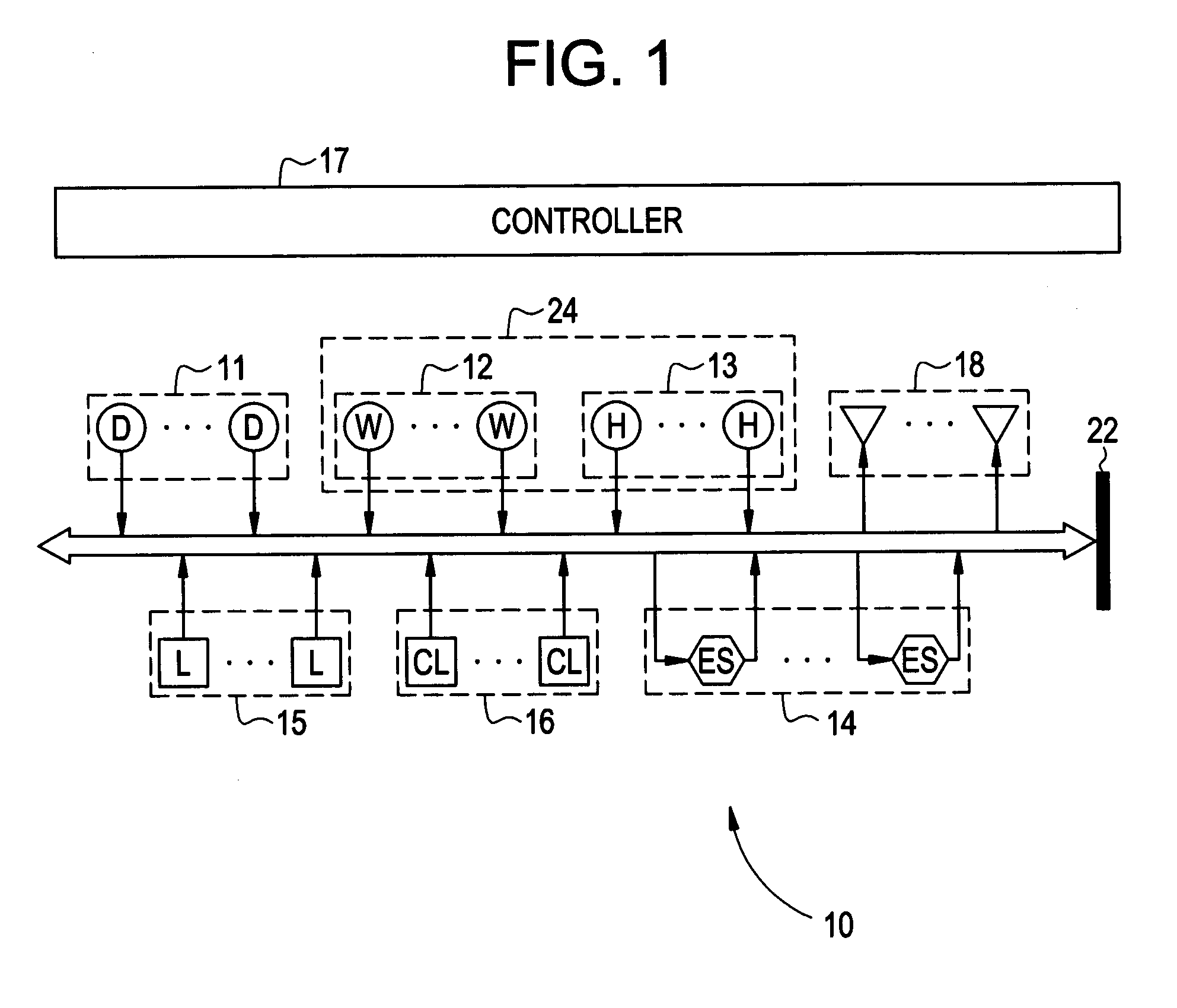

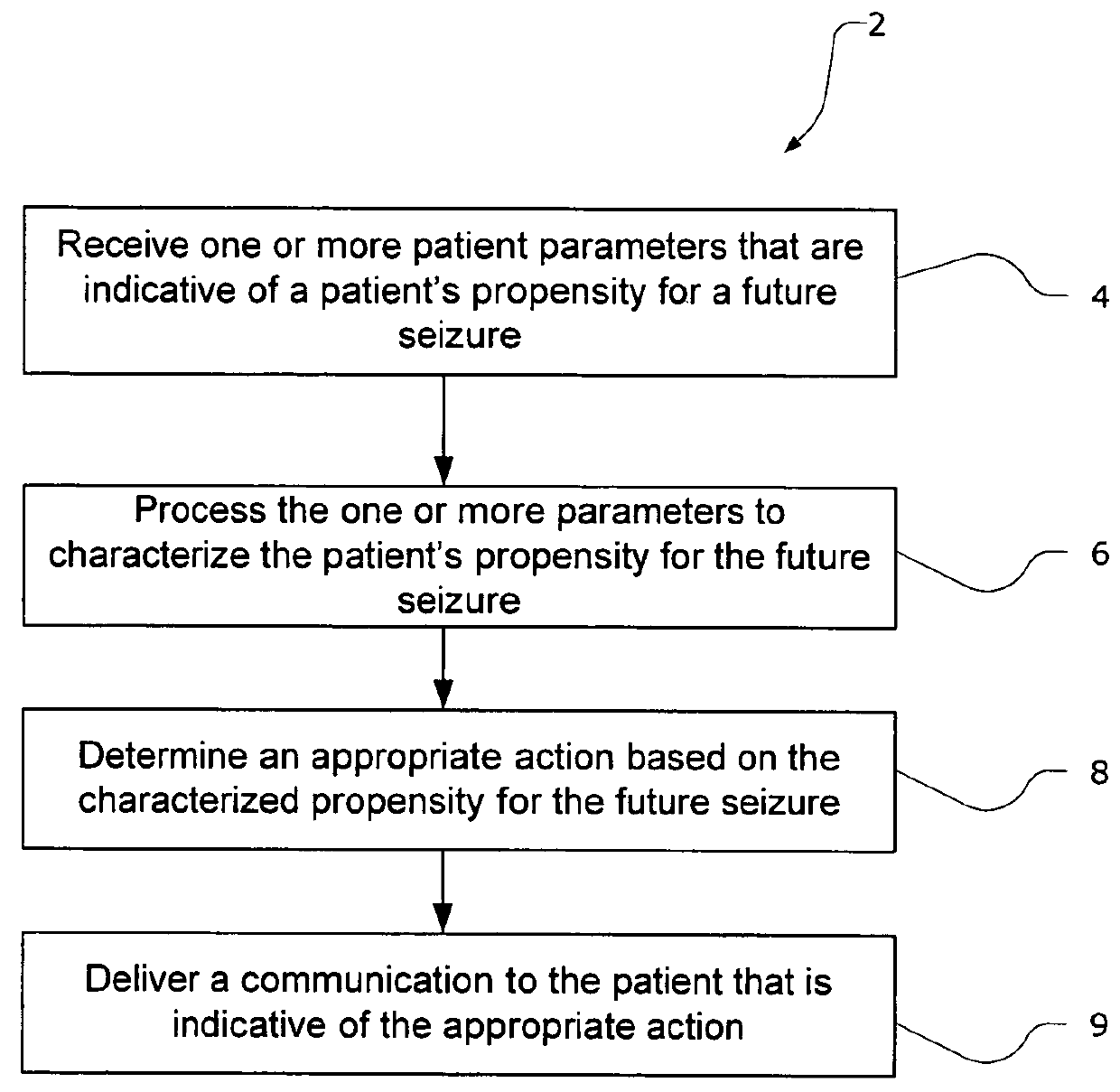

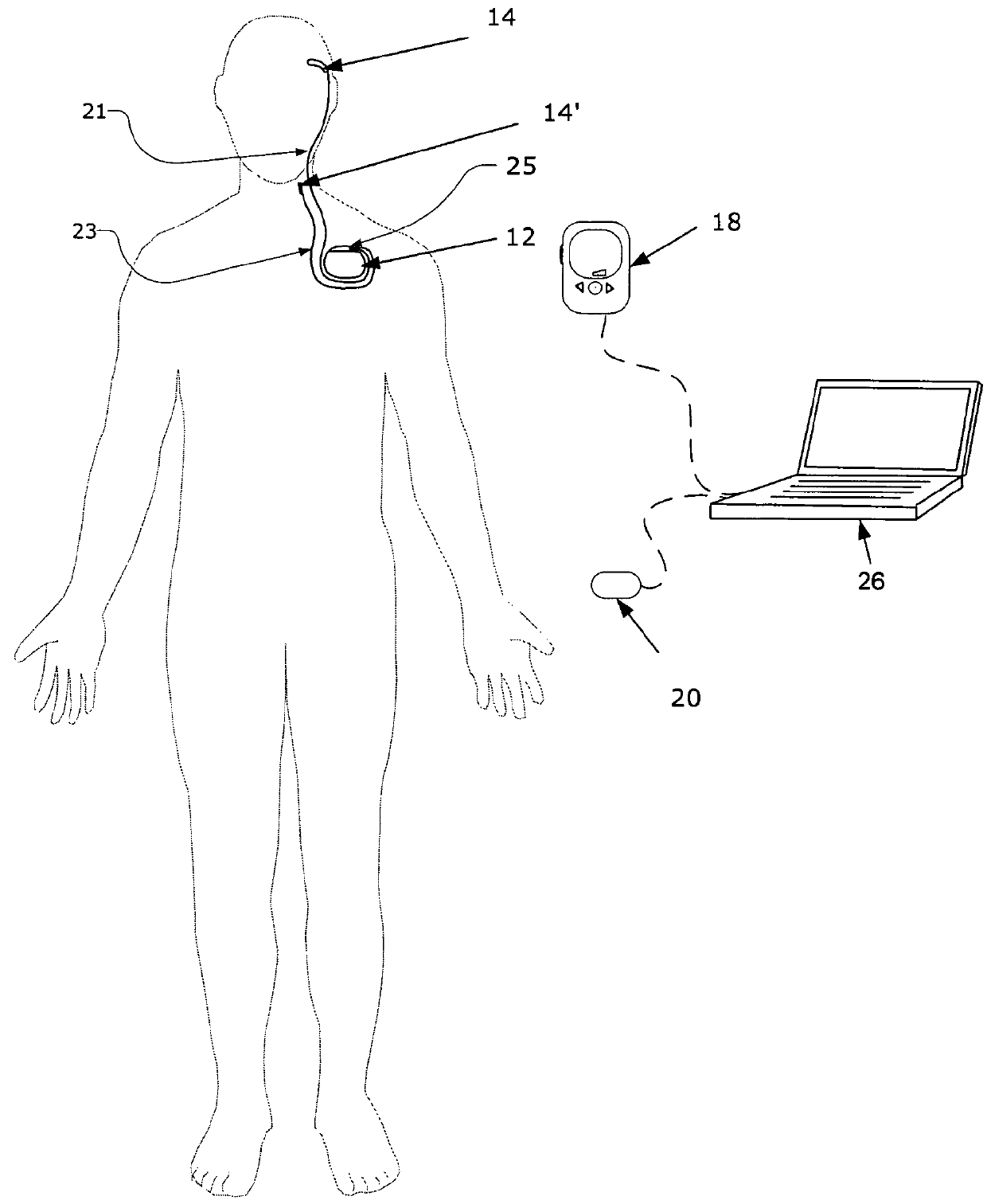

Methods and systems for recommending an appropriate action to a patient for managing epilepsy and other neurological disorders

ActiveUS20070150024A1Low profileIncrease probabilityElectroencephalographyPhysical therapies and activitiesNeurological disorderEpileptic seizure

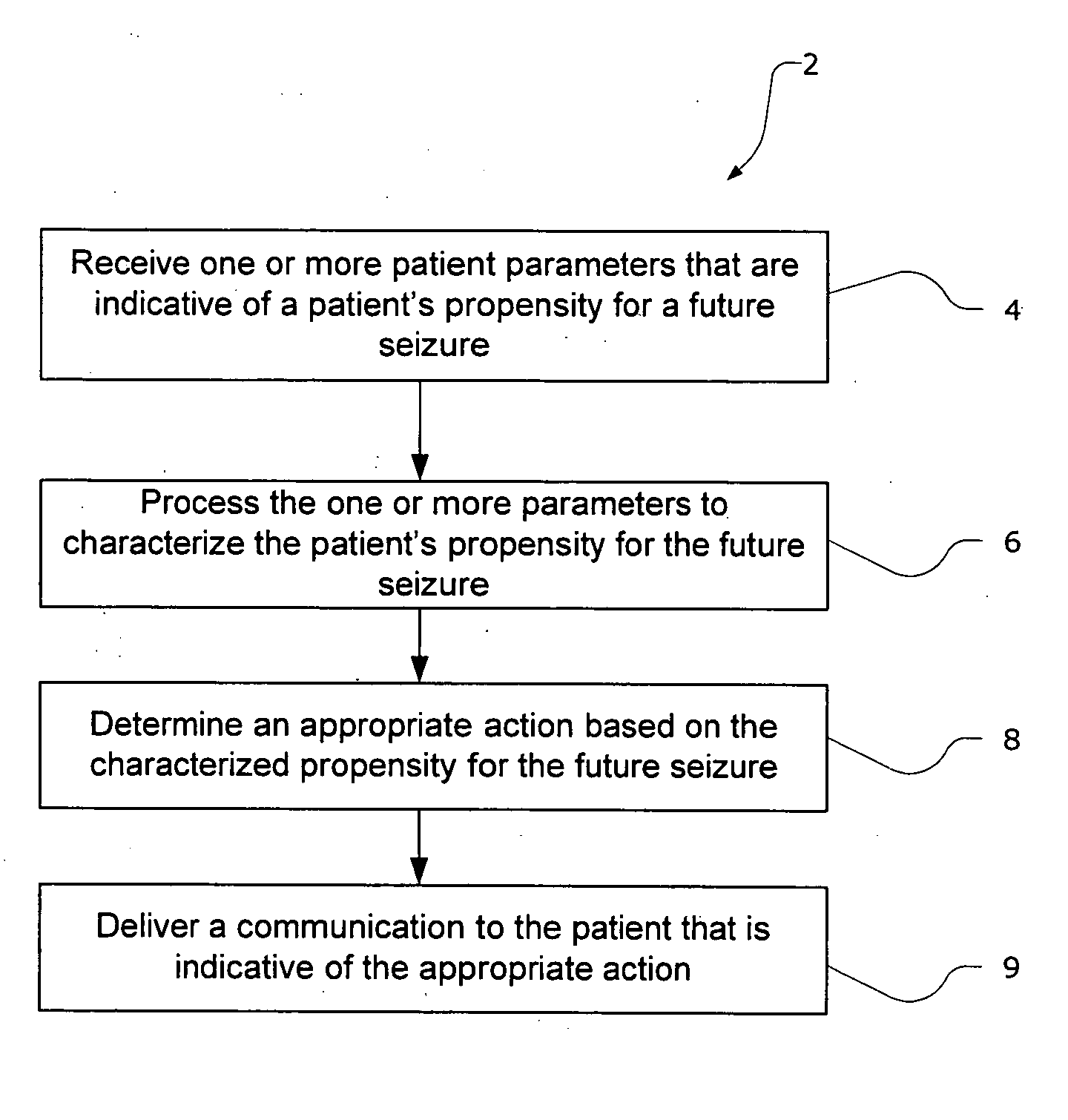

The present invention provides methods and system for managing neurological disorders such as epilepsy. In one embodiment, the method comprises measuring one or more signals from a patient and processing the one or more signals to characterize a patient's propensity for a future seizure. The characterized propensity for the seizure is thereafter used to determine an appropriate action for managing or treating the predicted seizure; and a recommendation is communicated to the patient that is indicative of the appropriate action.

Owner:CYBERONICS INC

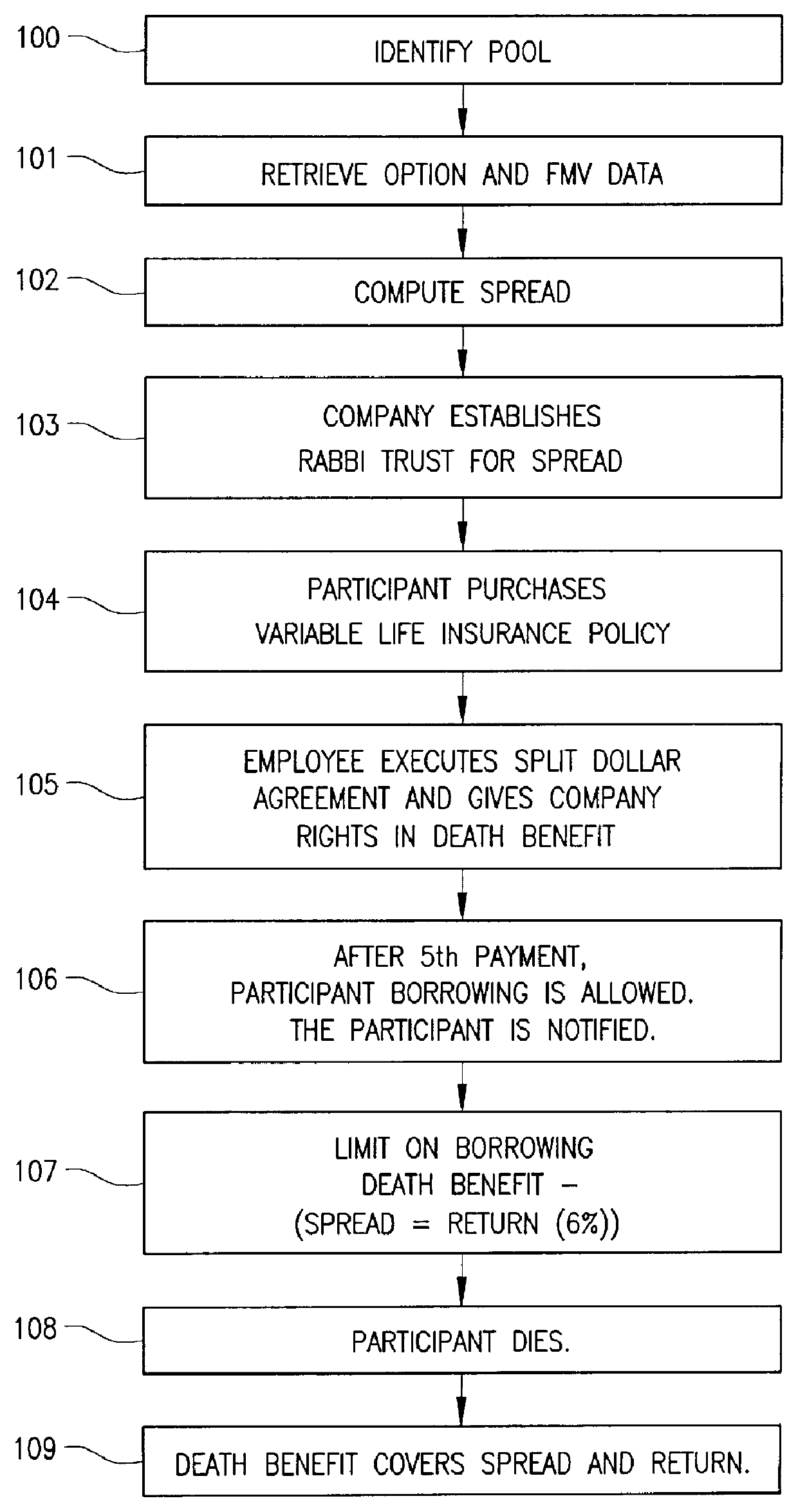

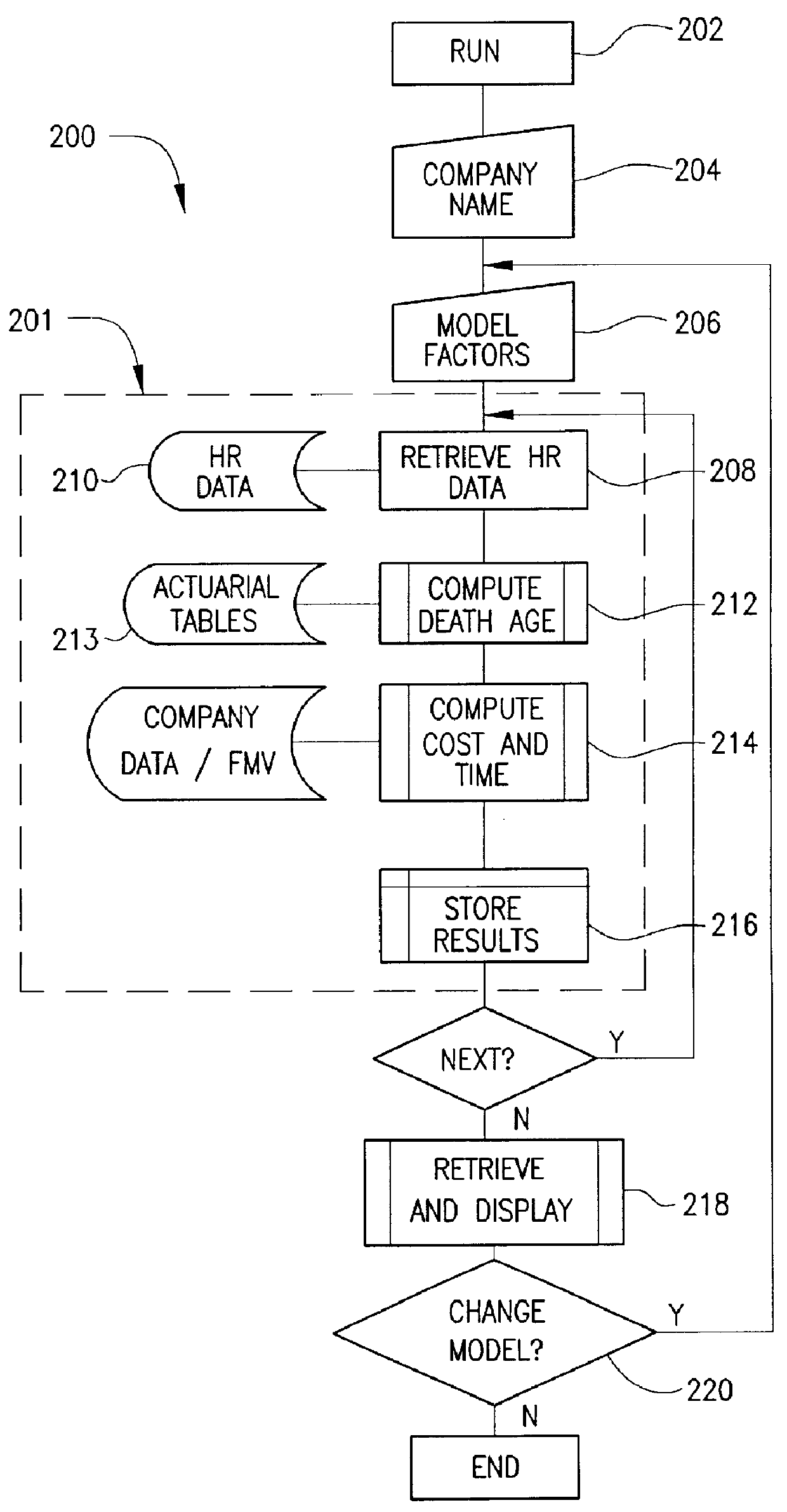

Method and apparatus for modeling and executing deferred award instrument plan

A method and apparatus for deferred award instrument plan by identifying at least one participant in the deferred award plan, retrieving financial data related to stock options corresponding to the identified participant, computing a spread associated with the retrieved stock options, establishing a rabbi trust with the spread, determining whether a life insurance policy has been purchased by the participant, determining whether a split dollar agreement has been executed, monitoring and paying at least one premium for the life insurance policy and notifying the participants that a payment associated with the life insurance policy has been paid.

Owner:ASCENSUS INSURANCE SERVICES

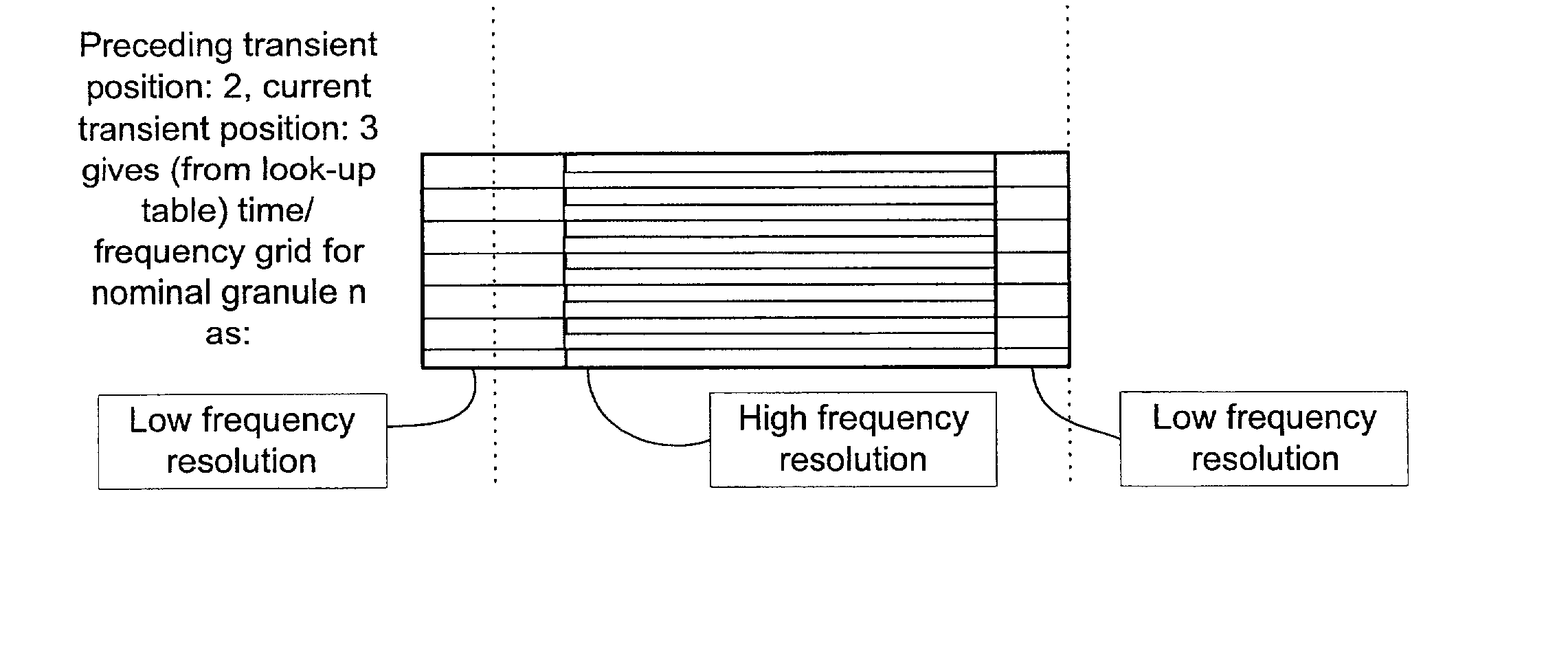

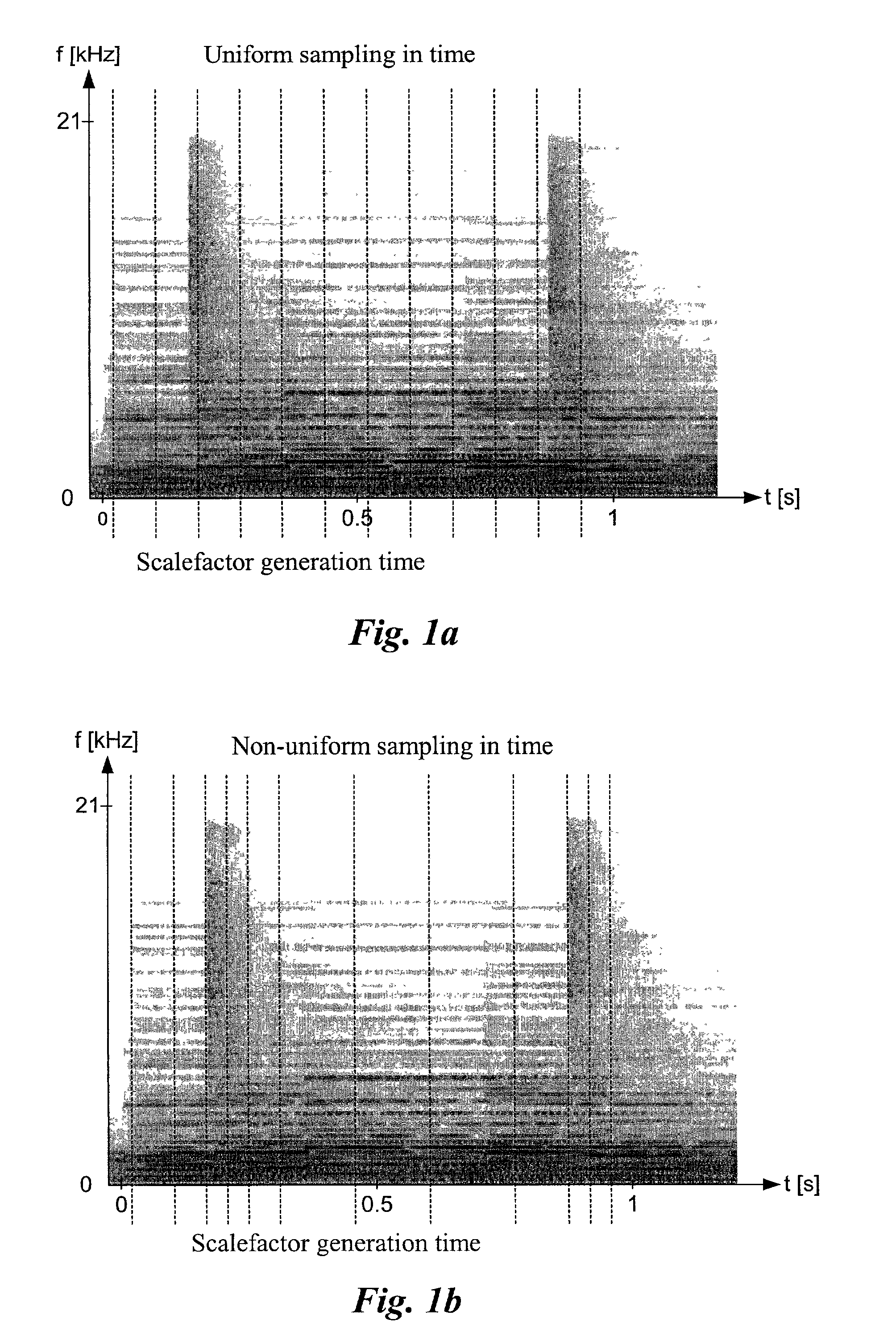

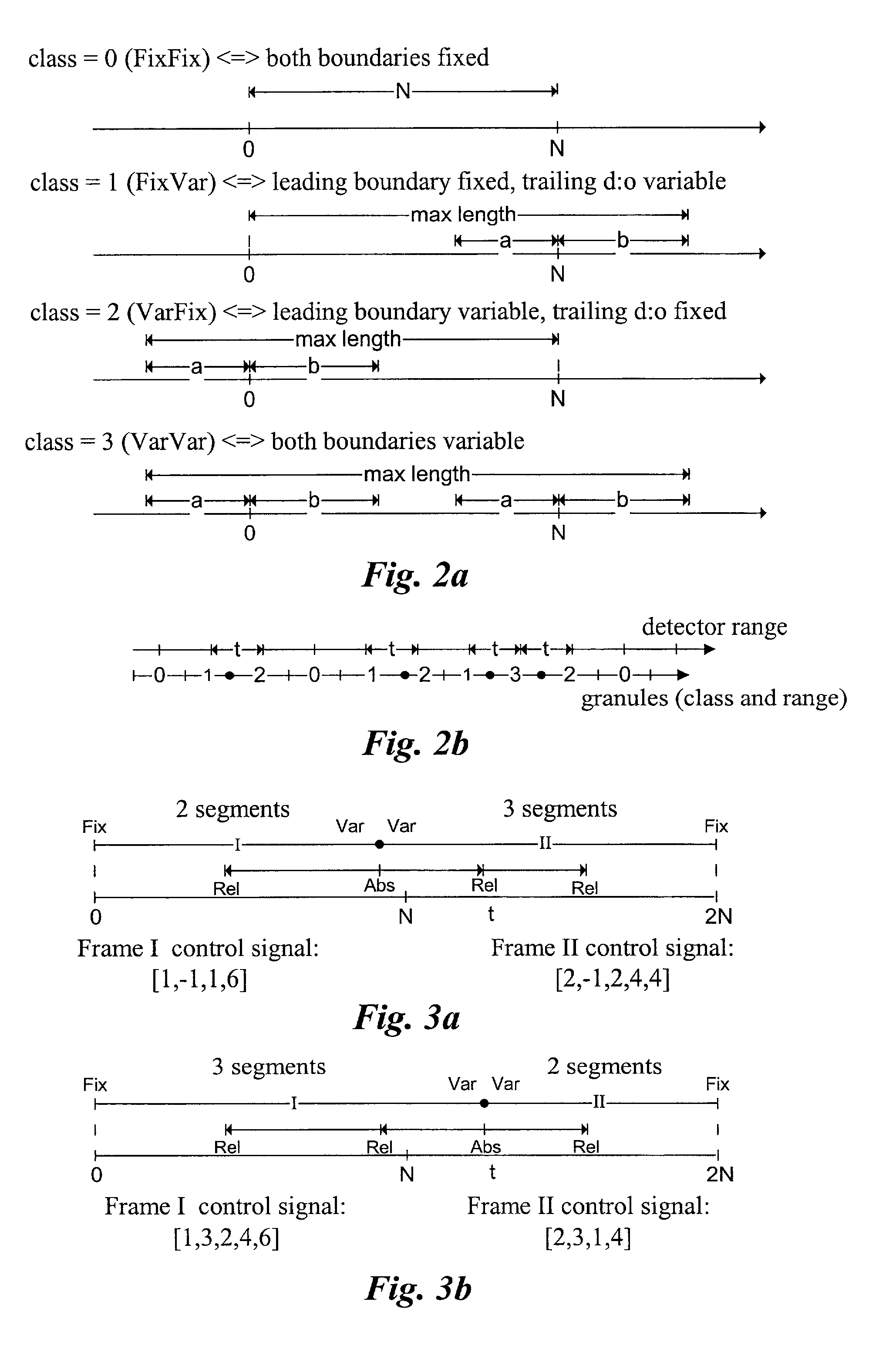

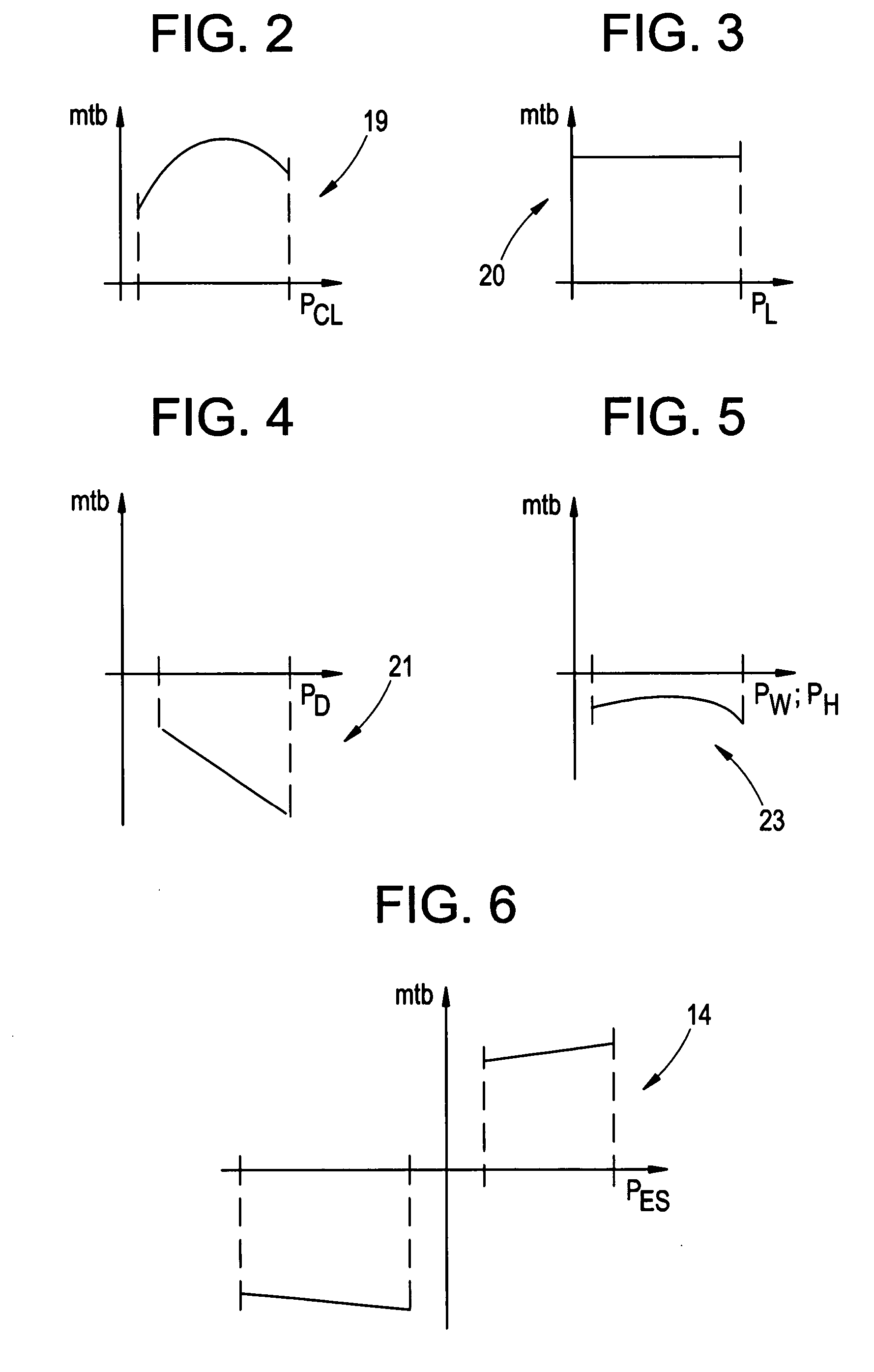

Efficient spectral envelope coding using variable time/frequency resolution and time/frequency switching

InactiveUS6978236B1Less variationImprove coding efficiencySpeech analysisDigital computer detailsSpectral envelopeImage resolution

The present invention provides a new method and an apparatus for spectral envelope encoding. The invention teaches how to perform and signal compactly a time / frequency mapping of the envelope representation, and further, encode the spectral envelope data efficiently using adaptive time / frequency directional coding. The method is applicable to both natural audio coding and speech coding systems and is especially suited for coders using SBR [WO 98 / 57436] or other high frequency reconstruction methods.

Owner:DOLBY INT AB

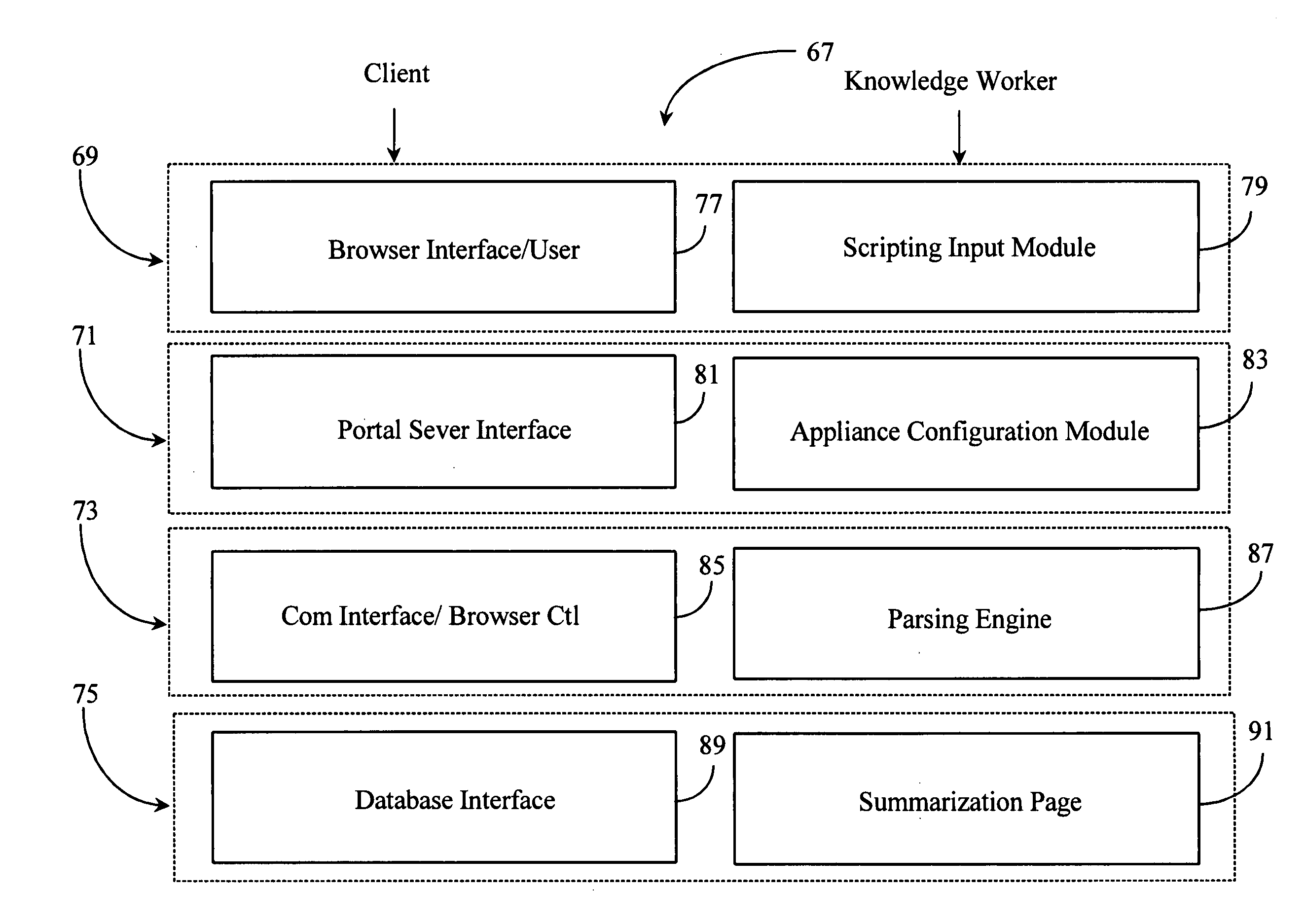

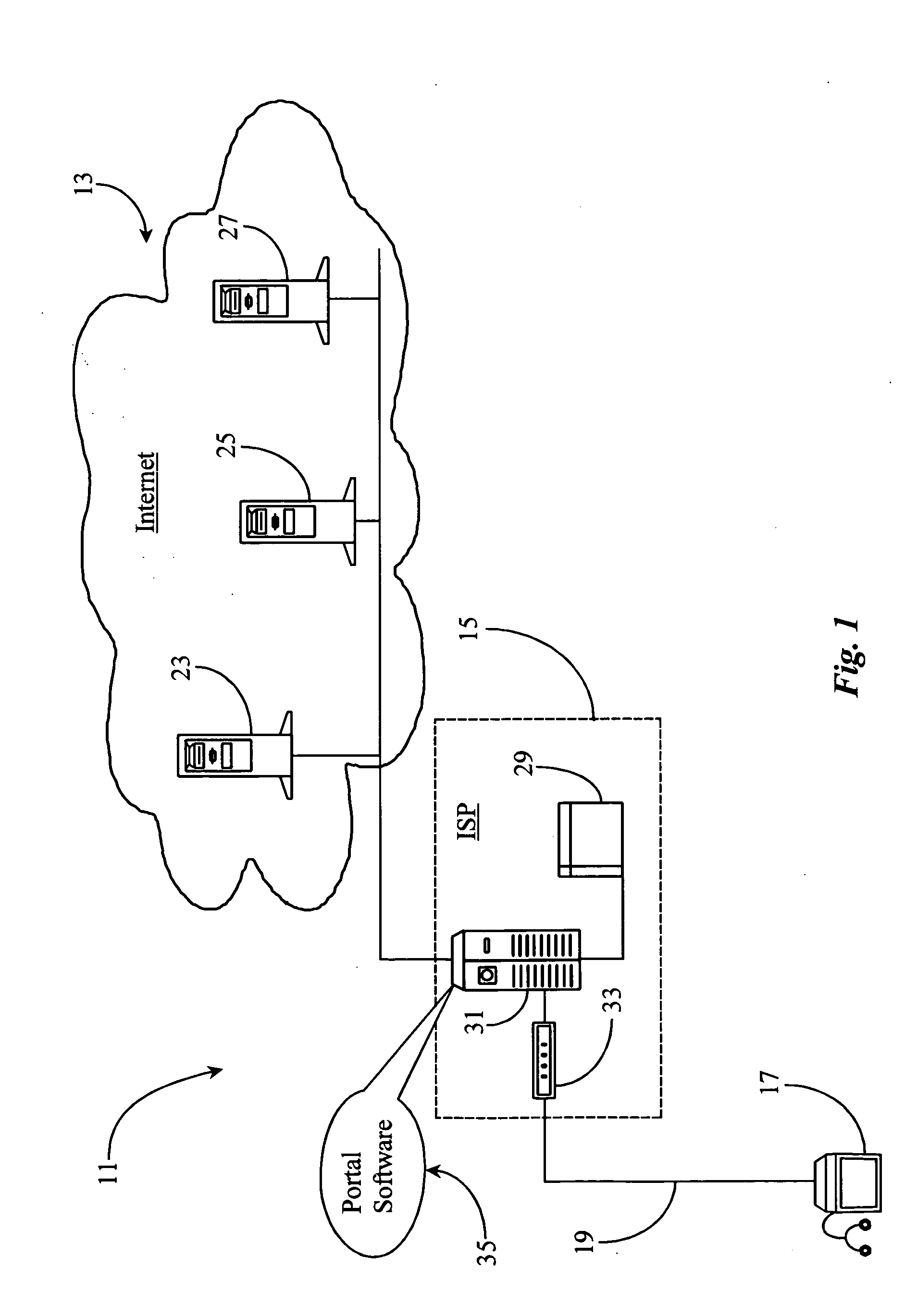

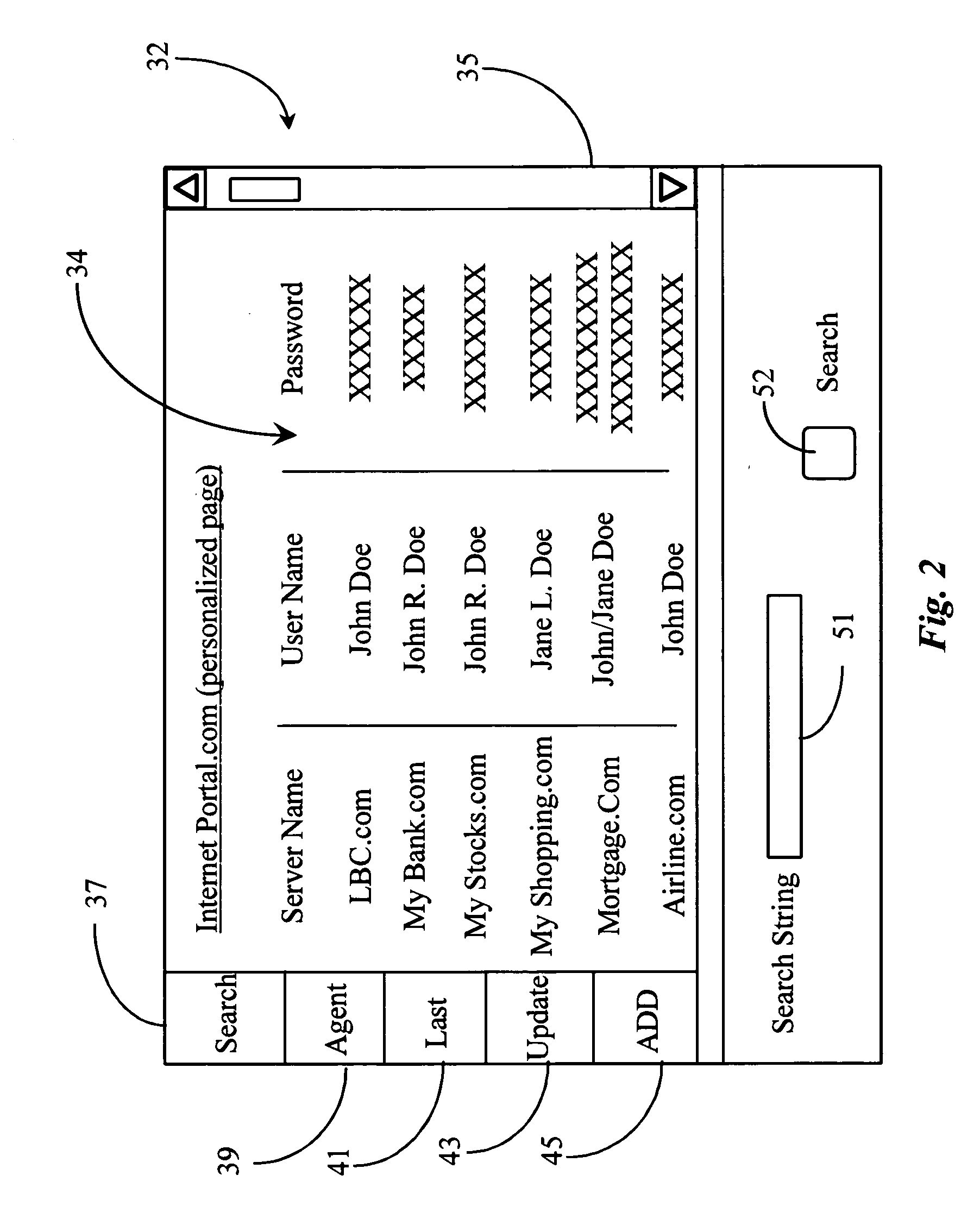

Network-based verification and fraud-prevention system

InactiveUS20060136595A1Maximize insurance protectionMaximize the benefitsFinanceMultiple digital computer combinationsProgramming language

A system and method authenticates a person requesting a service by soliciting an account identification from the person, using an automatic funds transfer protocol and the account identification to make a deposit in the account, entering a unique code in a field of the protocol that is retrievable from the account after the deposit is made, soliciting from the person, after the deposit has been made, the code entered into the field of the protocol, and matching the code returned by the person with the code entered into the field to make the deposit, a successful match authenticating the person. Transactions are also triggered by conditions in monitored accounts.

Owner:YODLEE COM INC

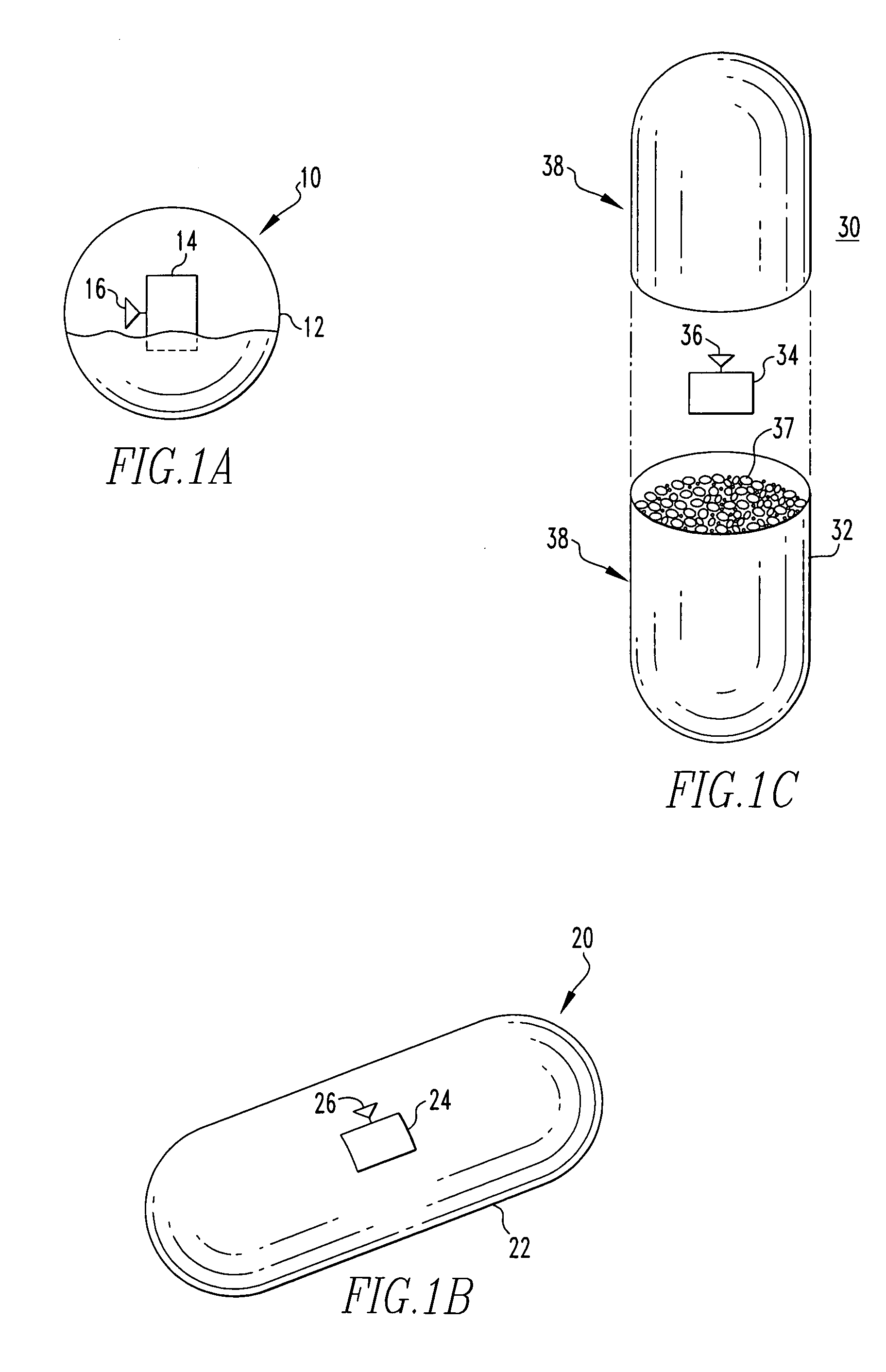

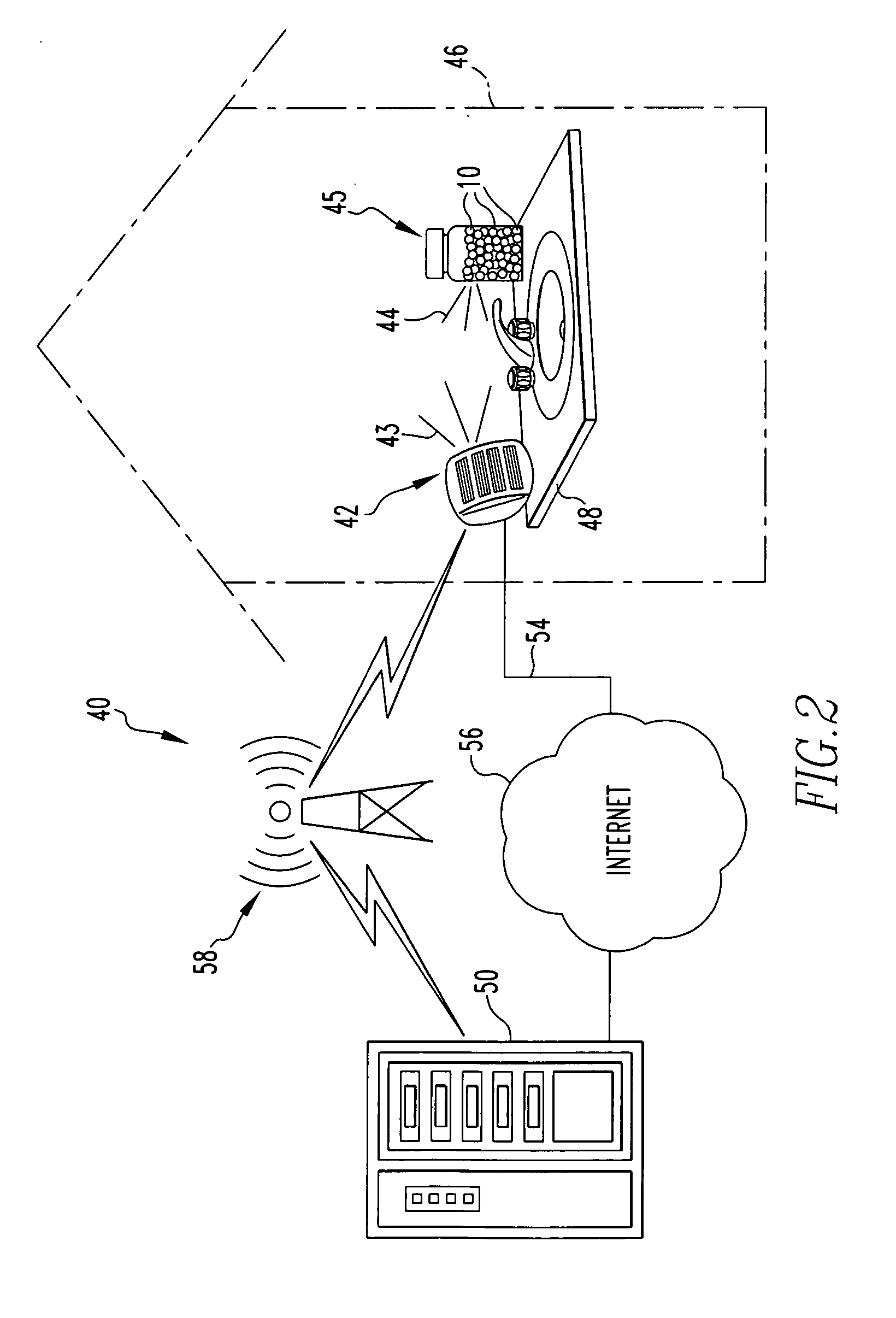

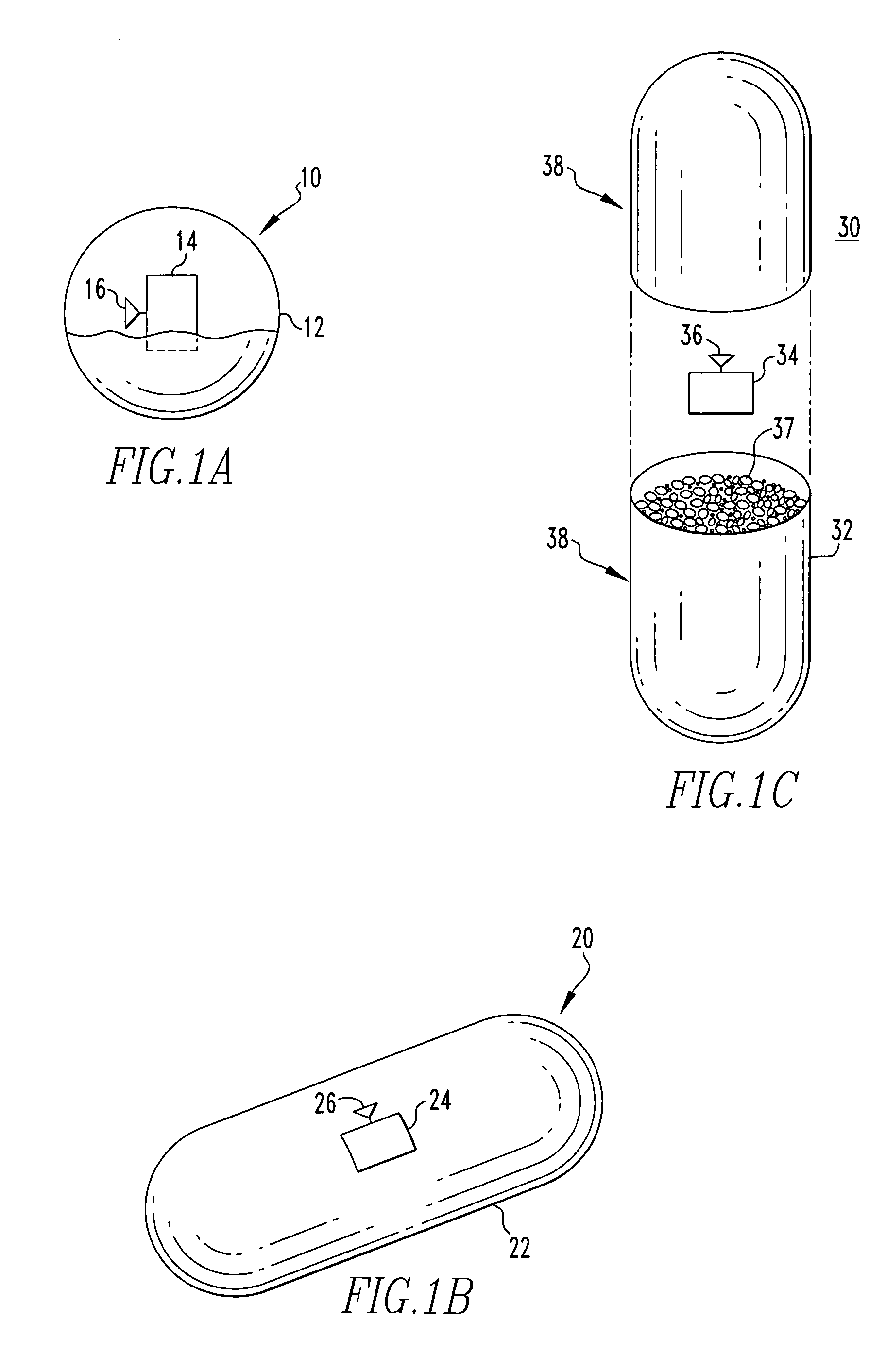

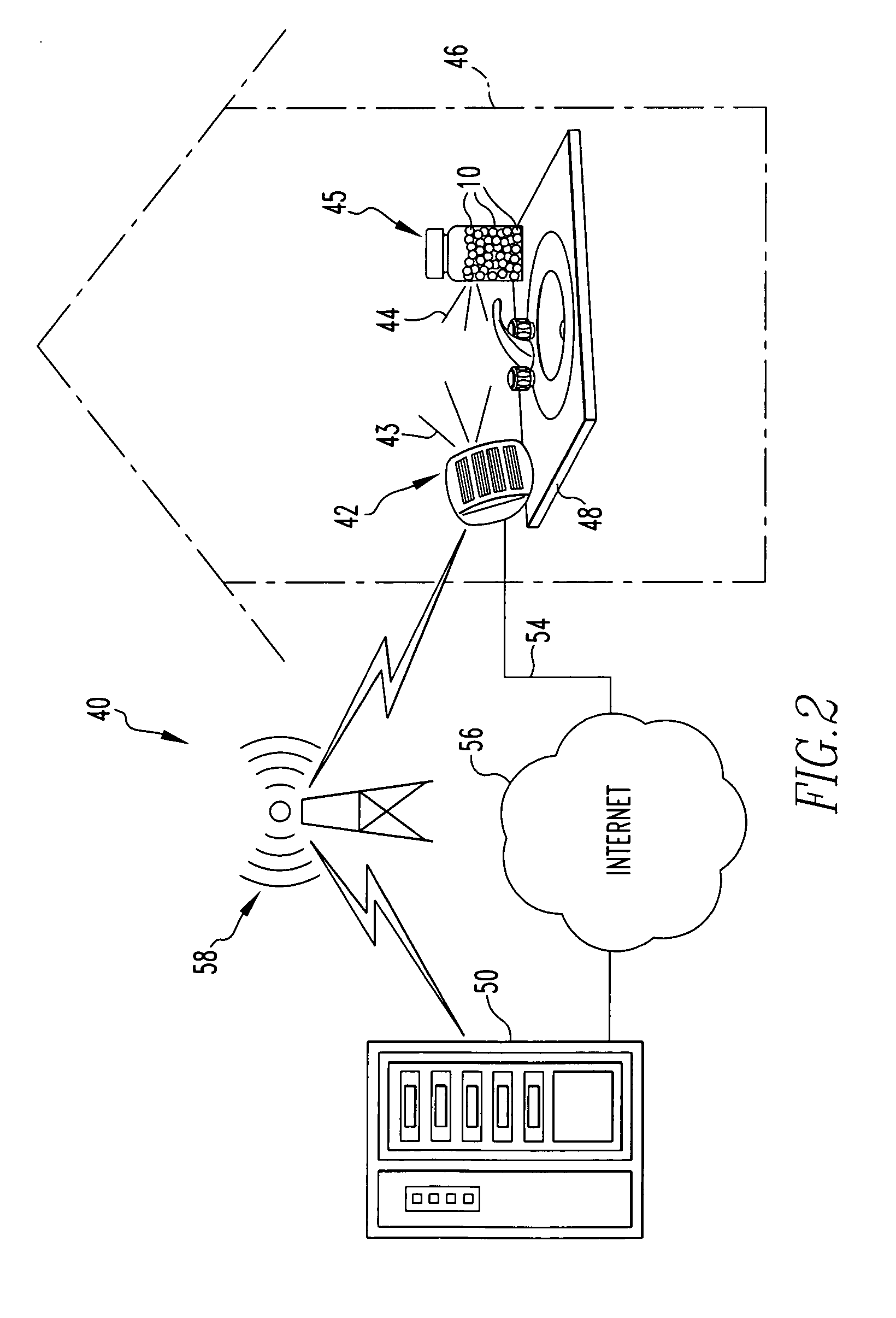

Radio frequency identification pharmaceutical tracking system and method

InactiveUS20060210626A1Effective treatmentQuickly and efficiently be identifiedDrug and medicationsSignalling system detailsOrogastric tubeRadio frequency

An ingestible dosage form includes a pill containing a pharmaceutical content and an RF tag associated with the pill. The RF tag is configured to output a wireless response signal in response to a wireless excitation signal received by the RF tag from an RF reader. The ingestible dosage form includes memory for storing pill identifying information. The wireless response signal includes the pill identifying information which may be received and processed by the RF reader. A system for monitoring patient medicine intake compliance includes a monitoring device placed within communicative proximity of ingestible dosage forms to transmit the wireless excitation signal and receive the wireless response signal including pill identifying information from the ingestible dosage forms. A device for determining an identity of a pill and quantity thereof ingested by an individual includes a nasogastric / orogastric tube having an RF tag reader attached thereto for detecting RF tagged pills.

Owner:SPAEDER JEFFREY A

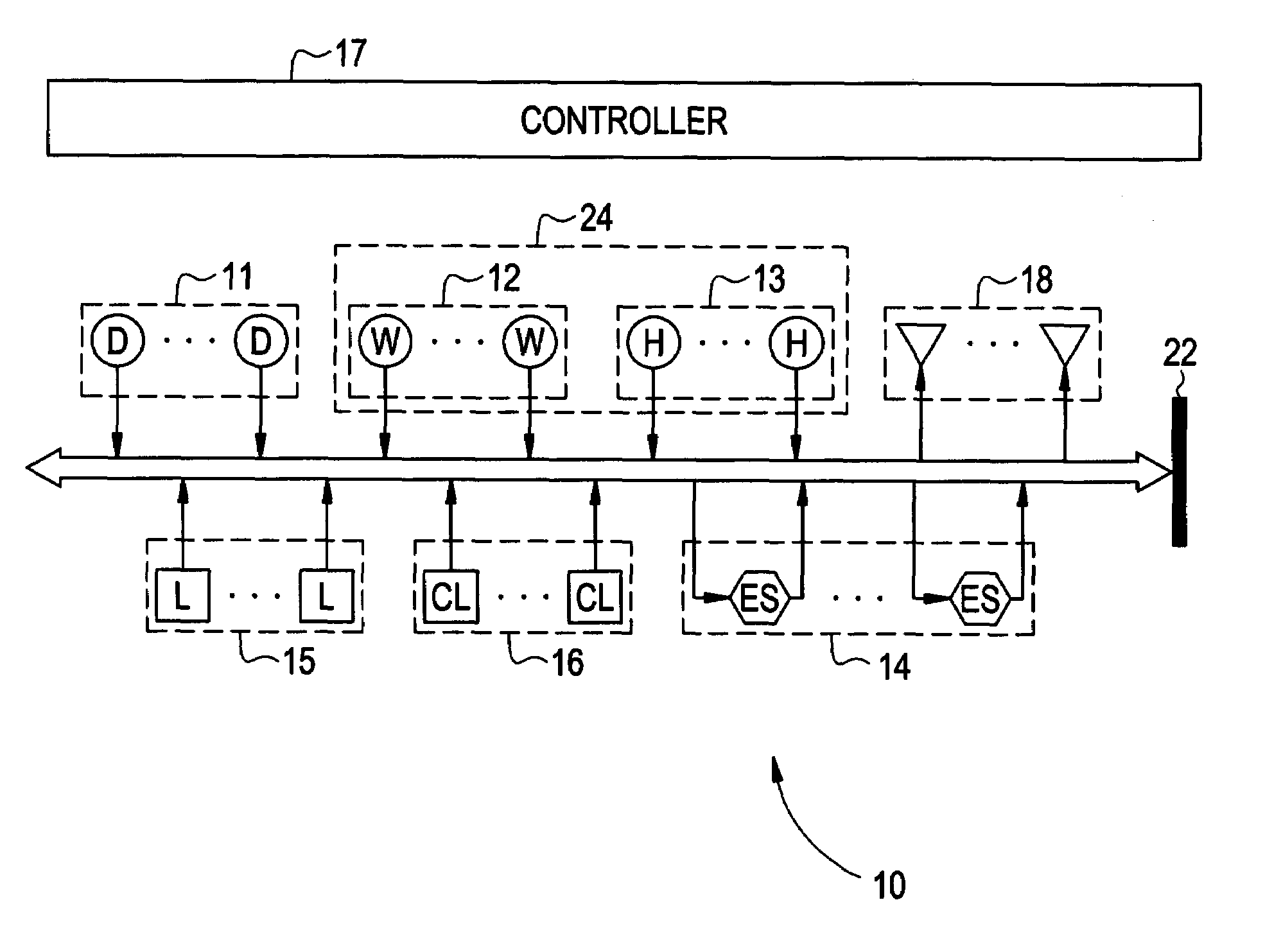

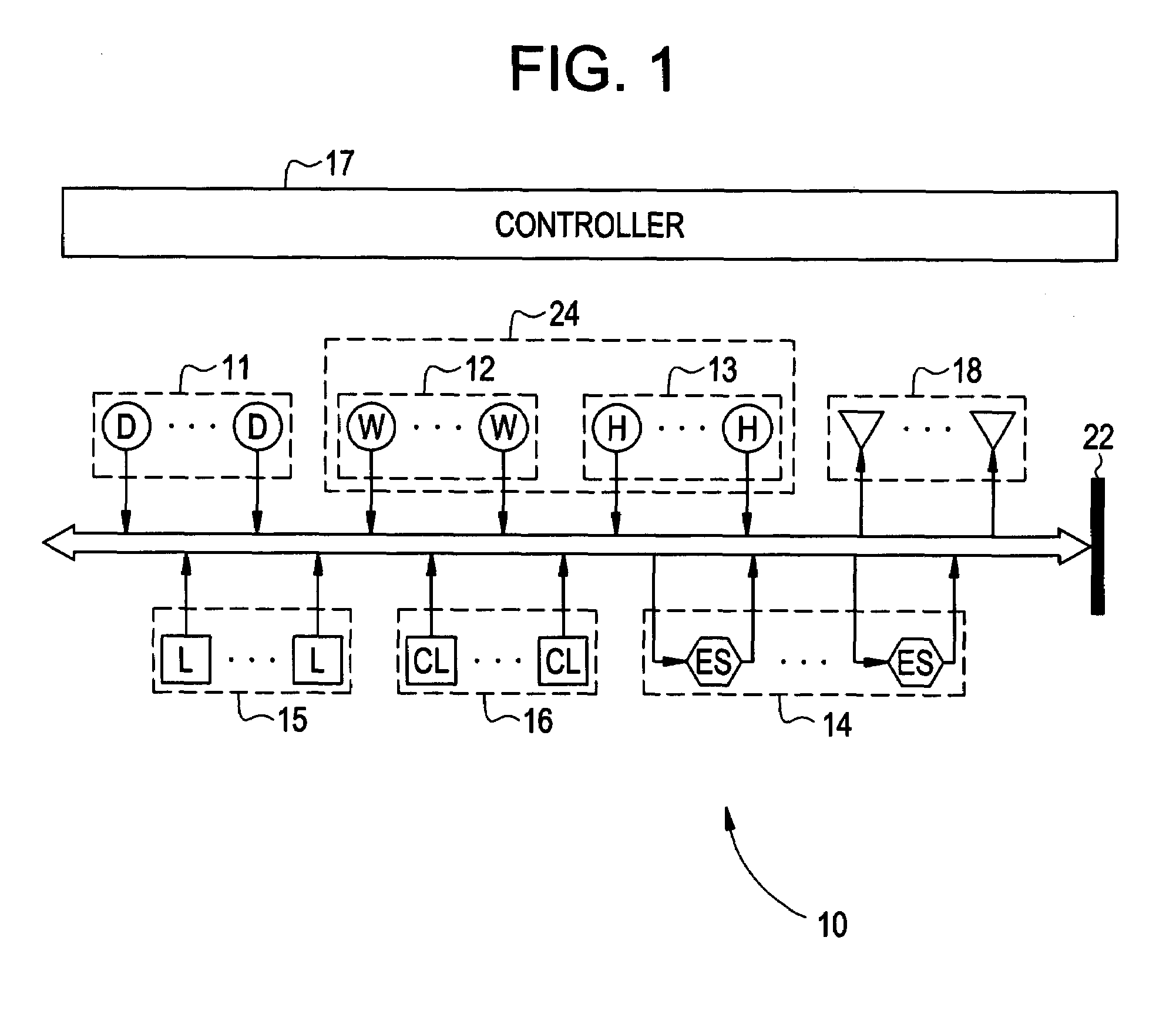

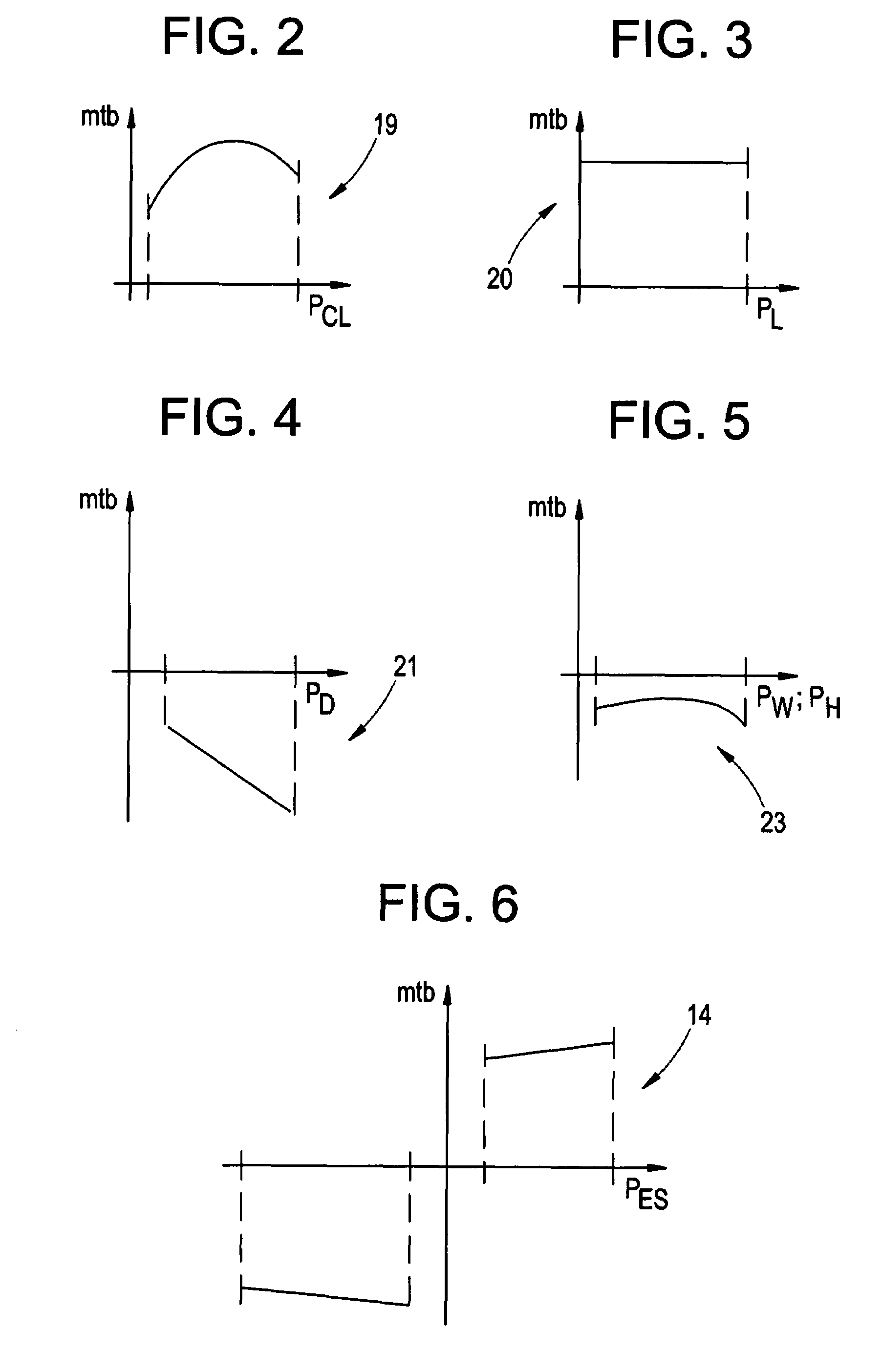

Multi-tier benefit optimization for operating the power systems including renewable and traditional generation, energy storage, and controllable loads

ActiveUS20070100503A1Maximize the benefitsSampled-variable control systemsMechanical power/torque controlElectric power systemPower grid

A plurality of power generating assets are connected to a power grid. The grid may, if desired, be a local grid or a utility grid. The power grid is connected to a plurality of loads. The loads may, if desired, be controllable and non-controllable. Distribution of the power to the loads is via a controller that has a program stored therein that optimizes the controllable loads and the power generating assets. The optimization process is via multi-tier benefit construct.

Owner:GENERAL ELECTRIC CO

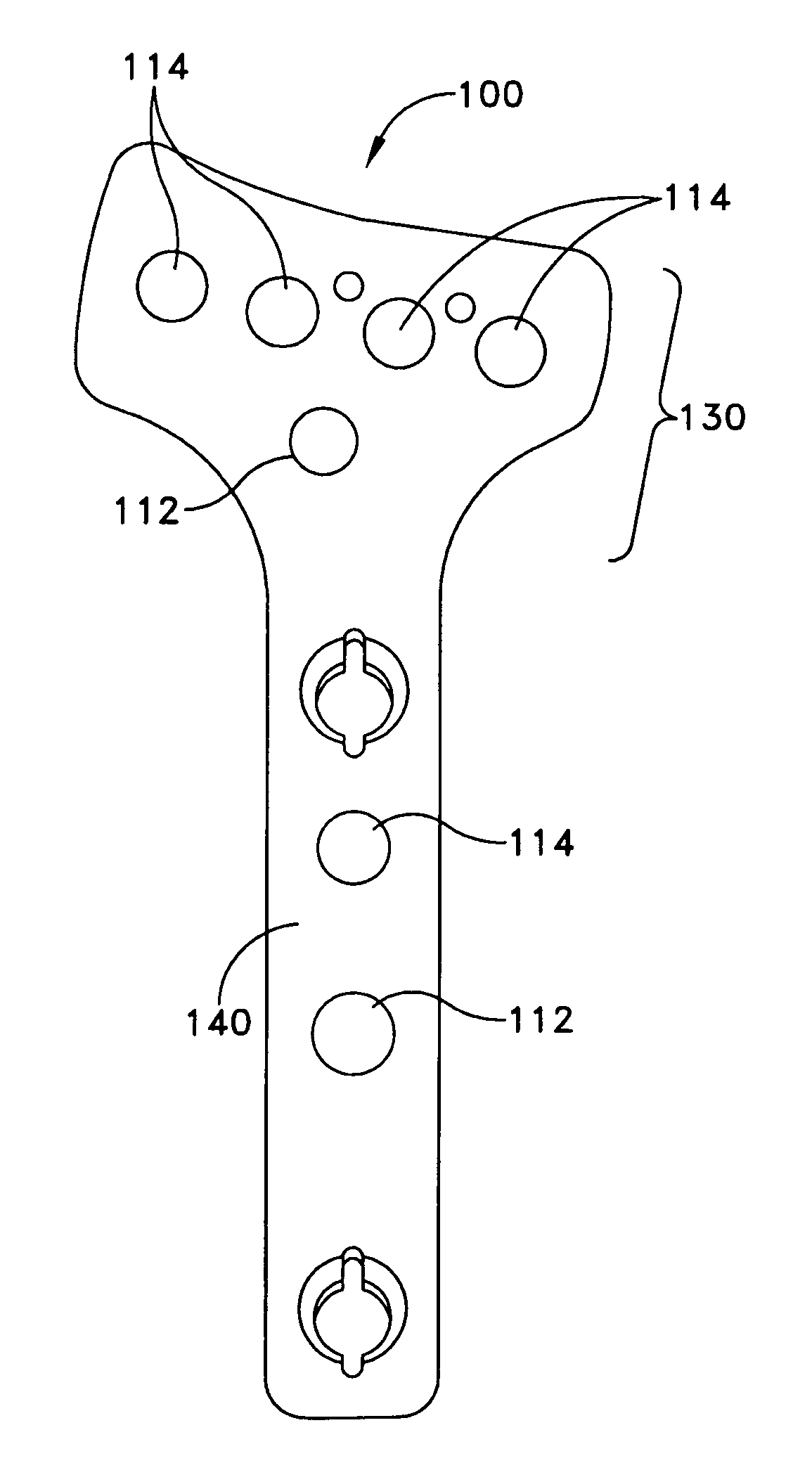

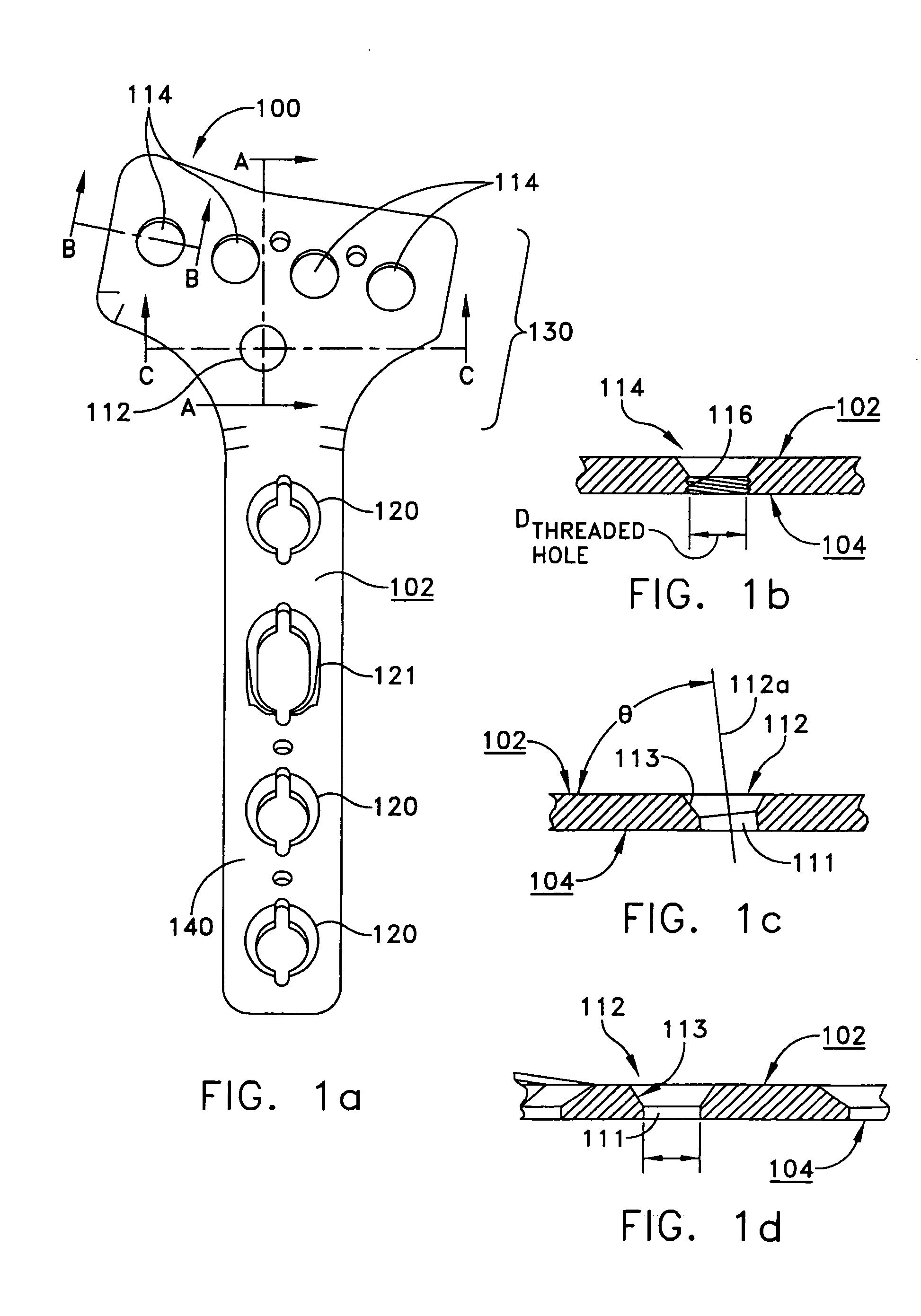

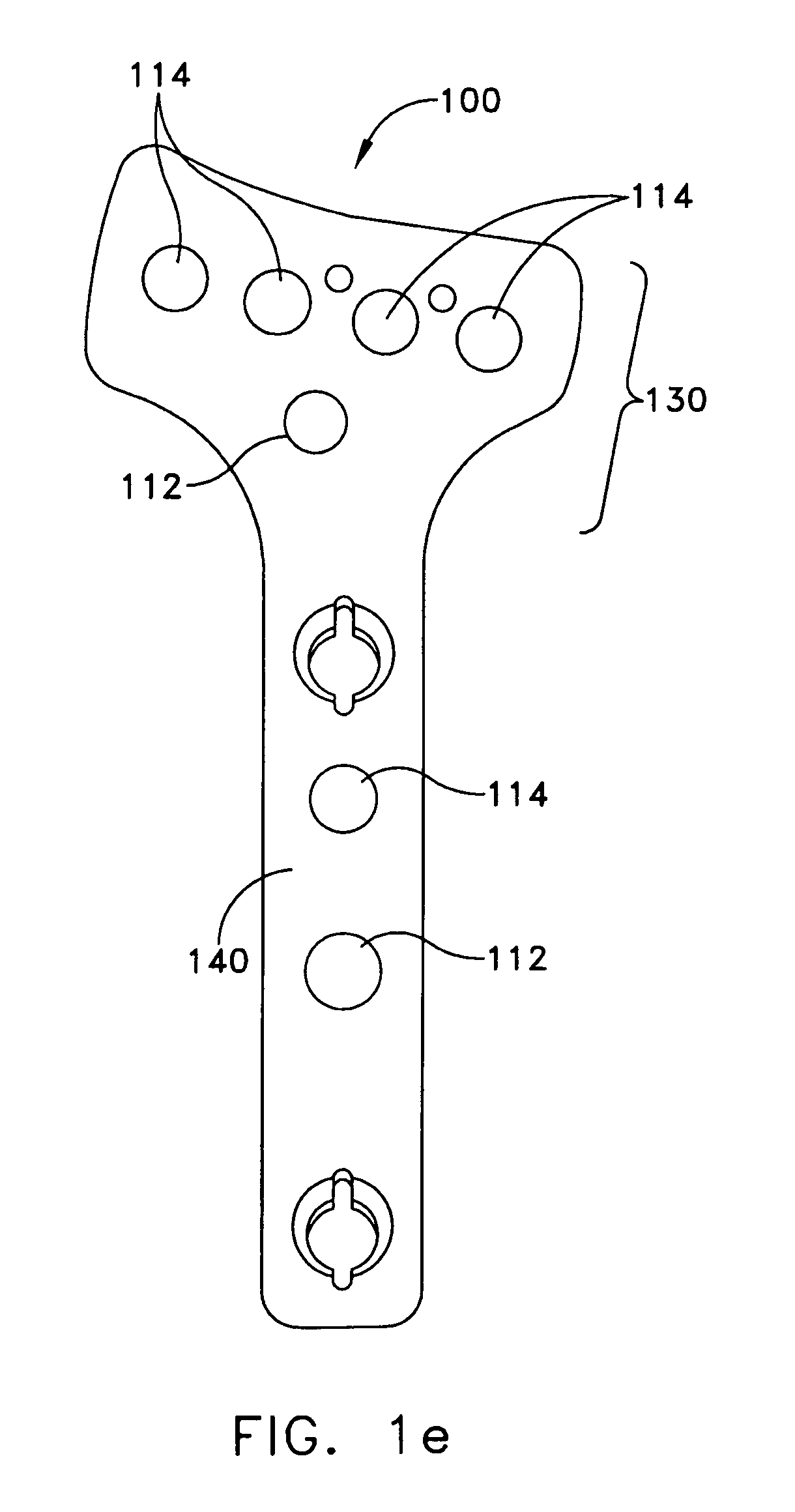

Distal radius bone plating system with locking and non-locking screws

Owner:WRIGHT MEDICAL TECH

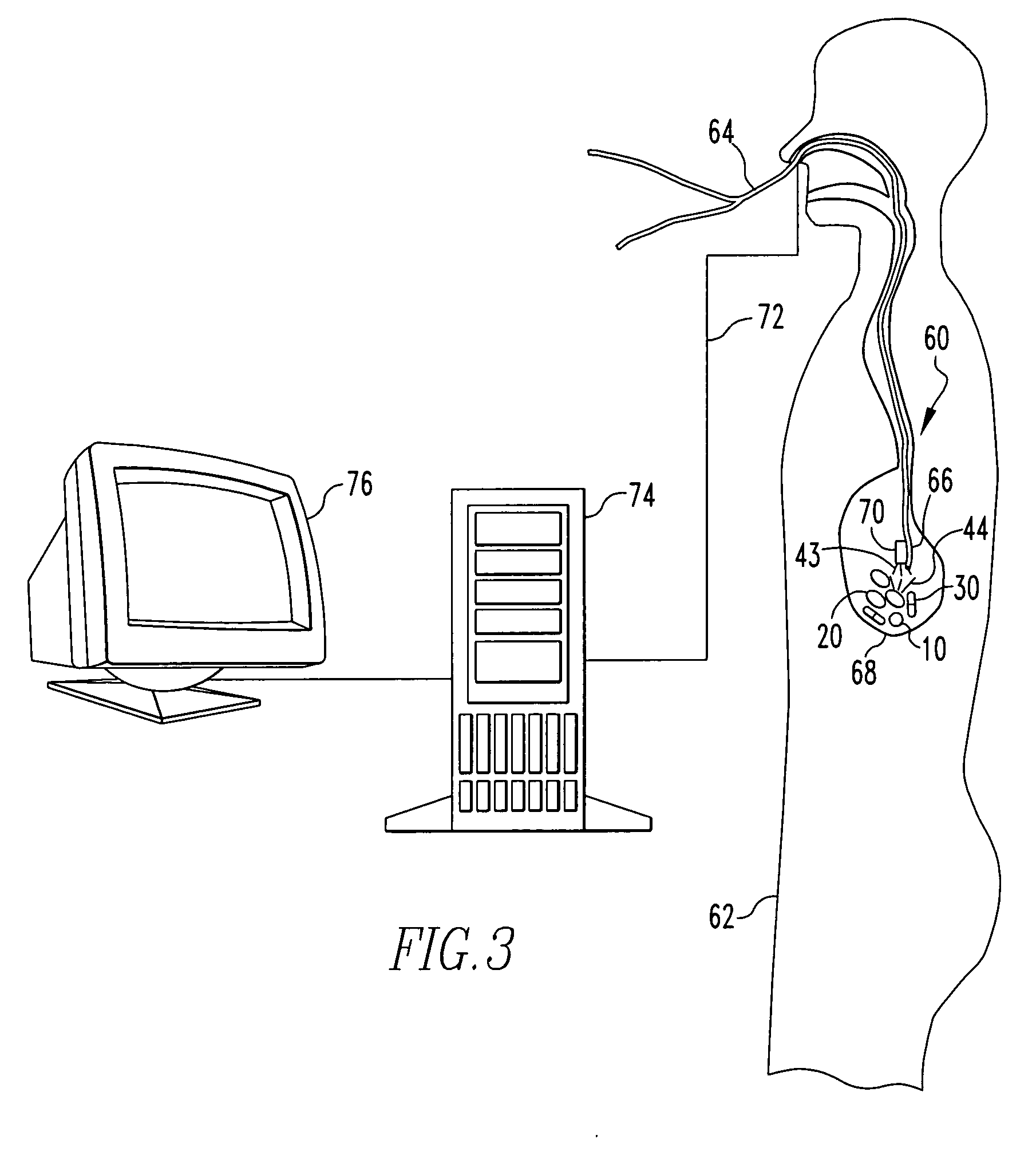

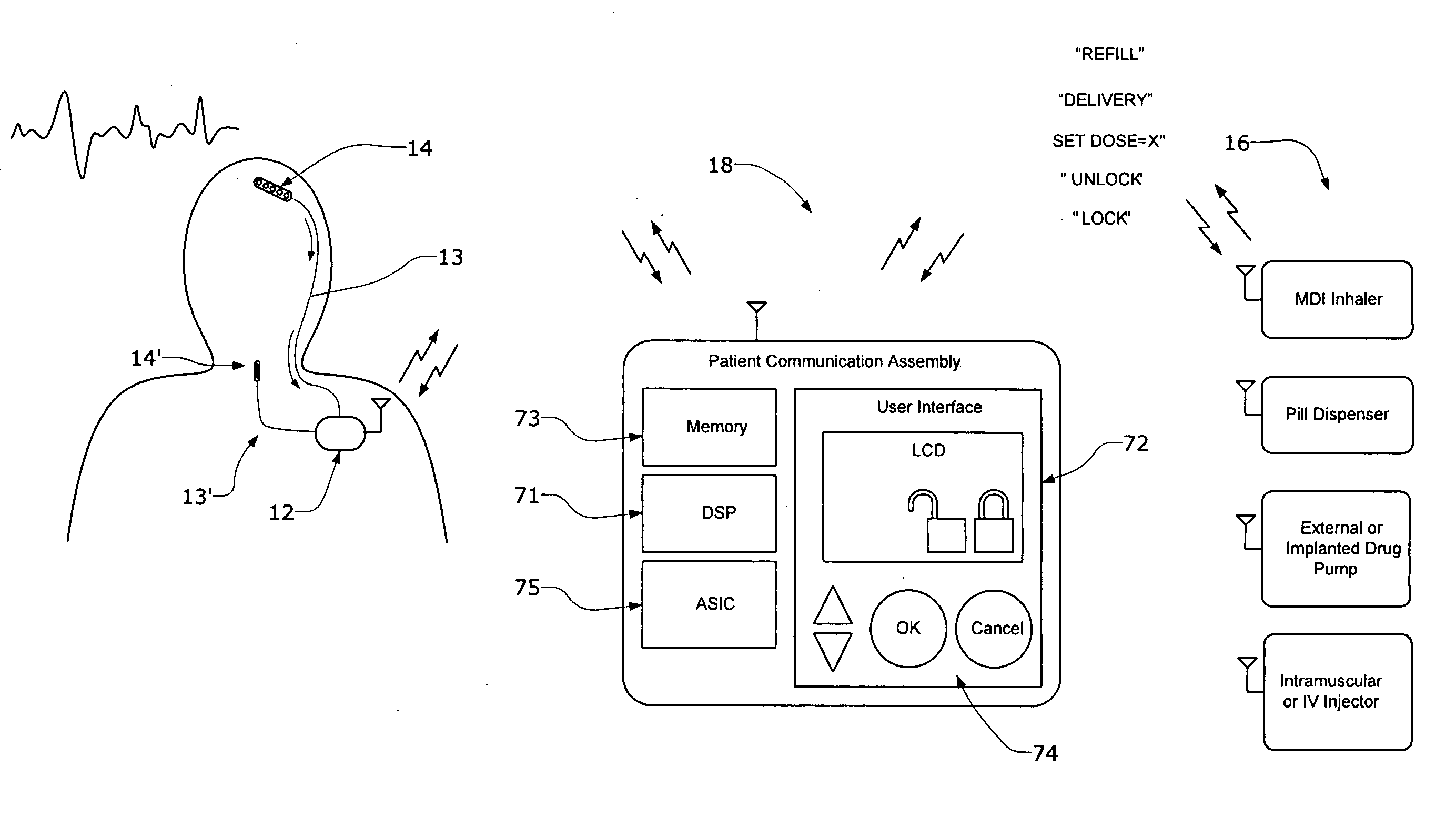

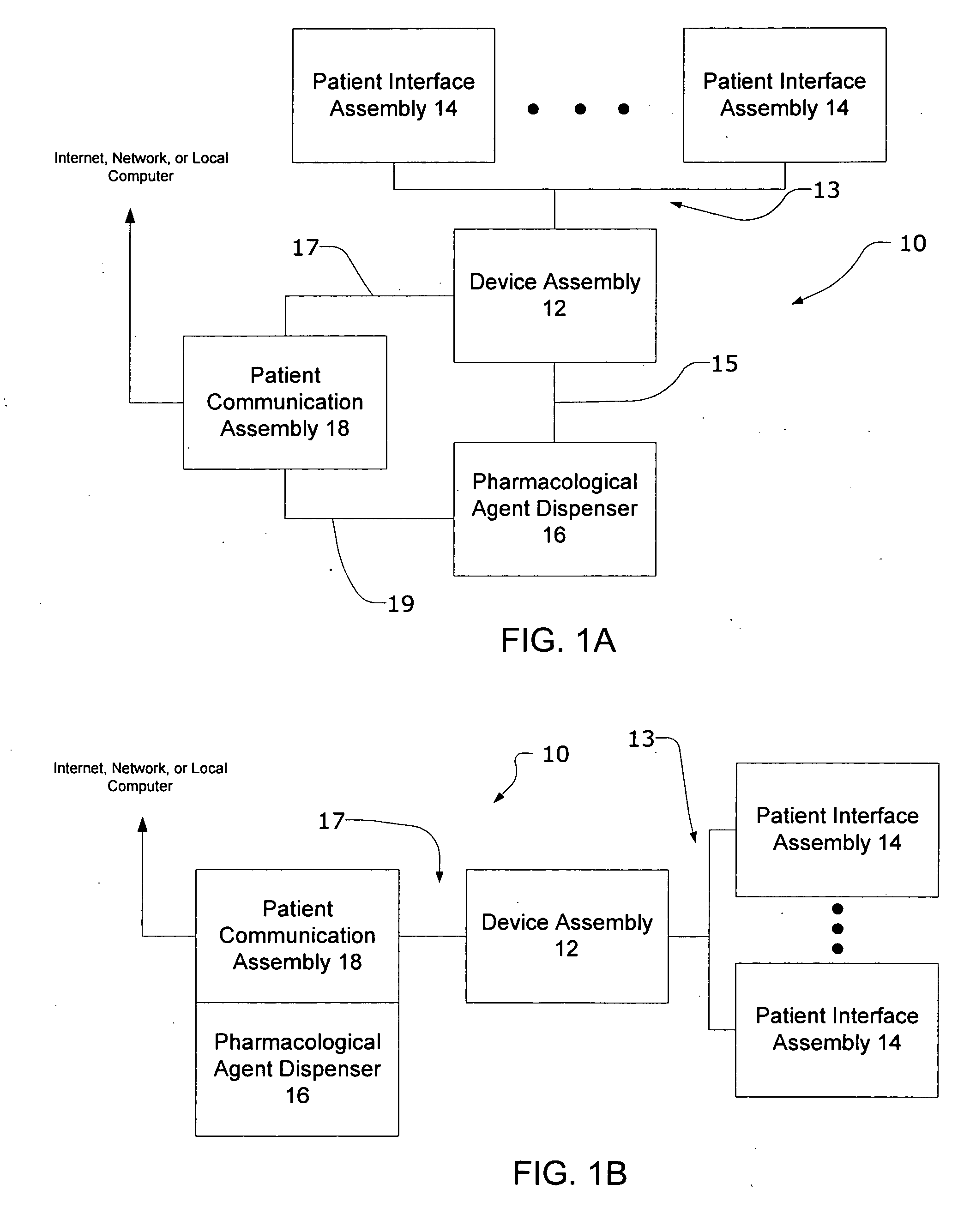

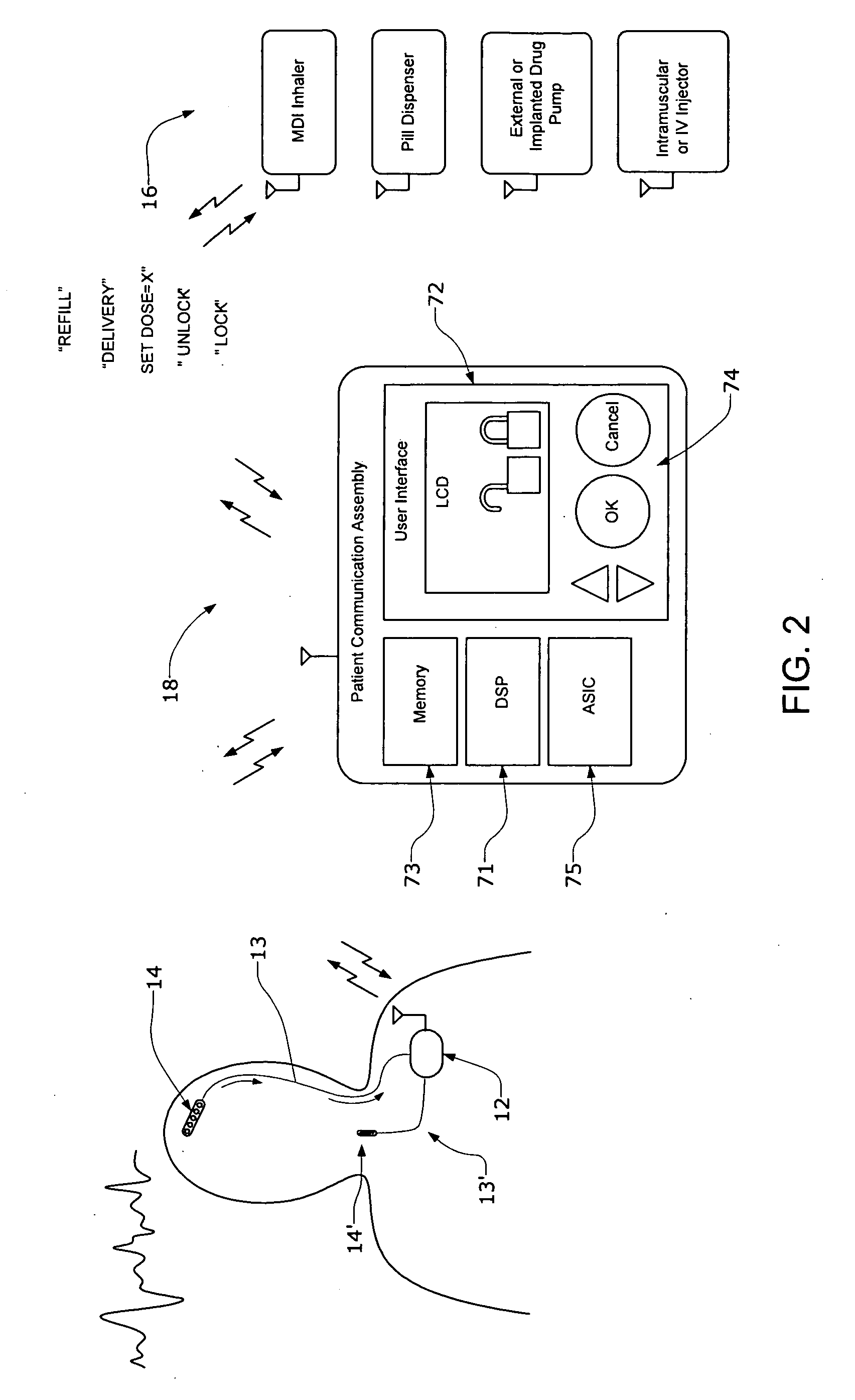

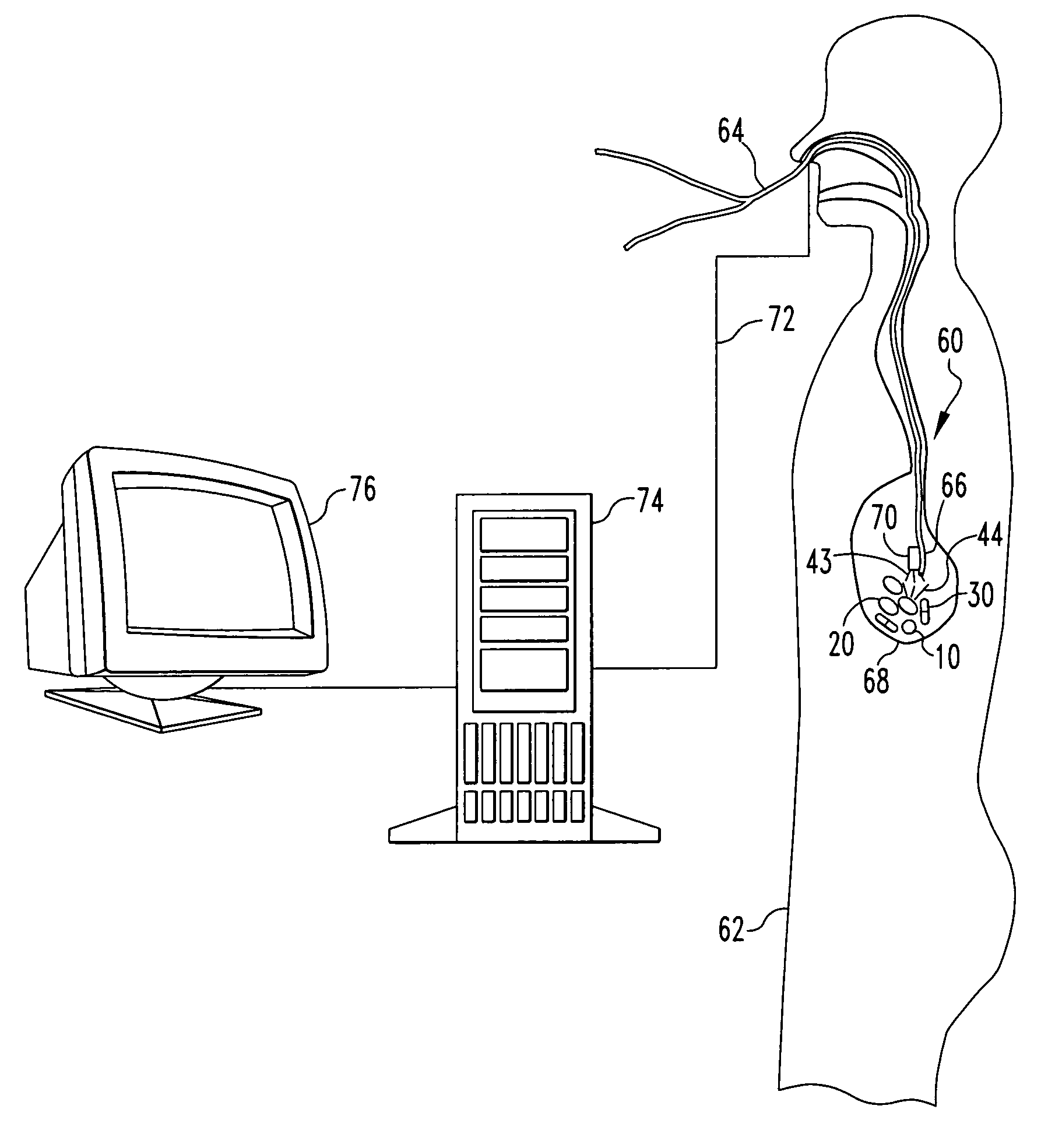

Systems and methods for characterizing a patient's propensity for a neurological event and for communicating with a pharmacological agent dispenser

InactiveUS20070149952A1Selectively limit accessSelectively limit to administrationDrug and medicationsTelemedicinePharmacometricsAntiepileptic drug

The present invention provides systems and methods for managing intake of a pharmacological agent. In one method of the present invention, the systems and methods are for controlling intake of an anti-epileptic drug. In such embodiments, one or more signals from a patient are processed to predict an onset of a seizure. Upon the prediction of the seizure, the patient is allowed to access the pharmacological agent in a pharmacological agent dispenser.

Owner:CYBERONICS INC

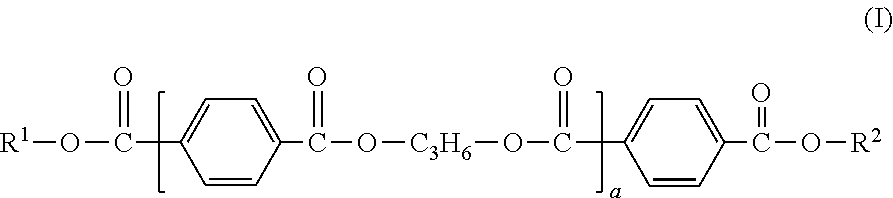

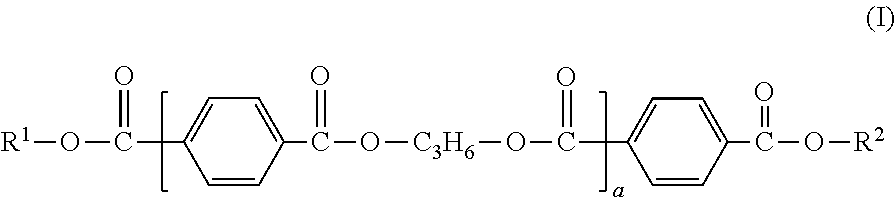

Alkaline liquid laundry detergent compositions comprising polyesters

InactiveUS9365806B2Maximize the benefitsEasy to cleanOrganic detergent compounding agentsSurface-active detergent compositionsPolyesterLiquid laundry detergent

An alkaline liquid laundry detergent composition comprising at least 1 wt % triethanolamine, at least 5 wt % non-soap surfactant and at least 0.5 wt % of a polyester according to the following formula (I) wherein R1 and R2 independently of one another are X—(OC2H4)n-(OC3H6)m wherein X is C1-4 alkyl, the —(OC2H4) groups and the —(OC3H6) groups are arranged blockwise and the block consisting of the —(OC3H6) groups is bound to a COO group or are HO—(C3H6), n is based on a molar average a number of from 12 to 120, preferably 40 to 50, m is based on a molar average a number of from 1 to 10, and a is based on a molar average a number of from 4 to 9. The inventive compositions comprise polyesters that have an advantageous stability in their alkaline environment and also possess advantageous soil release properties.

Owner:CONOPCO INC D B A UNILEVER

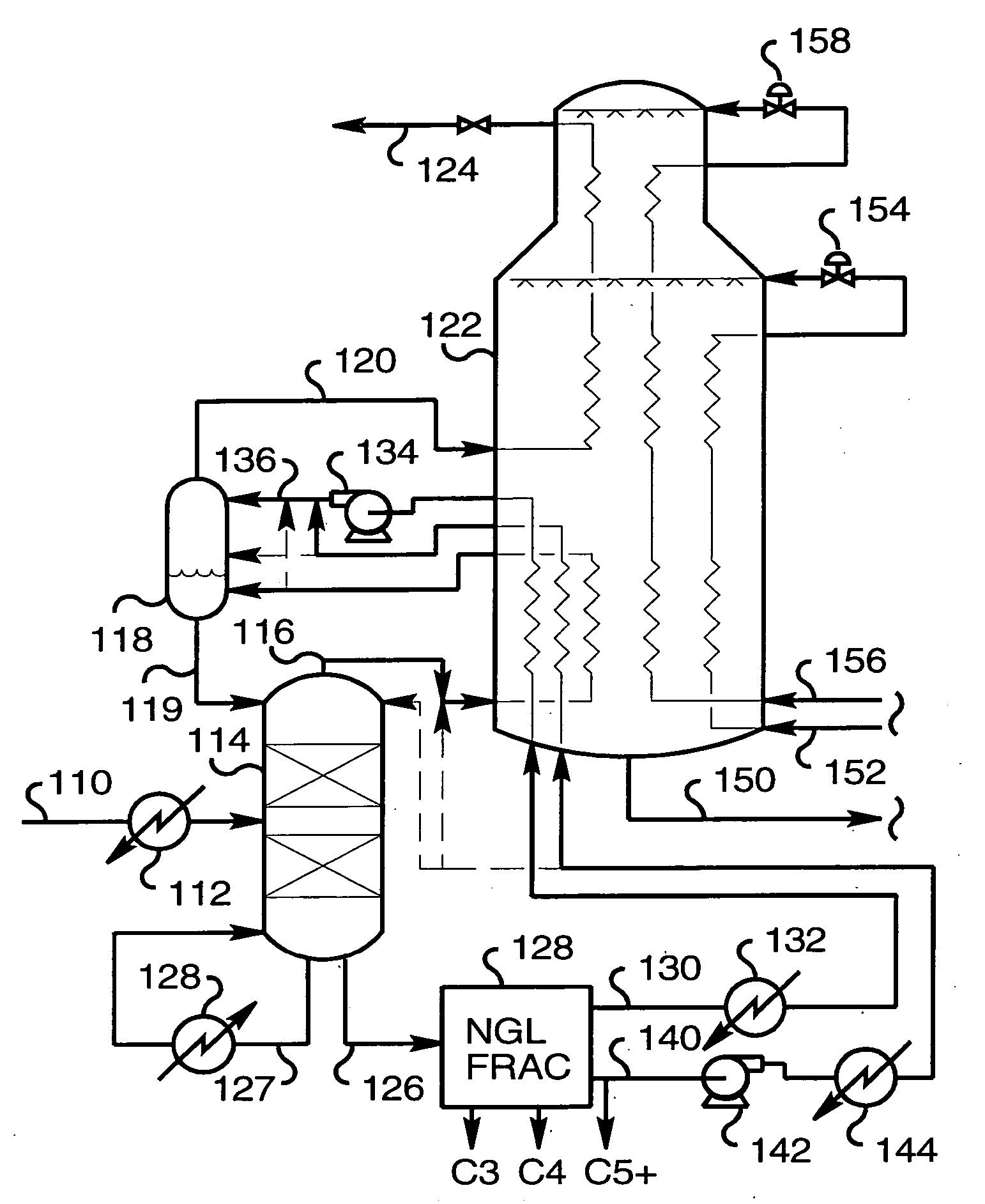

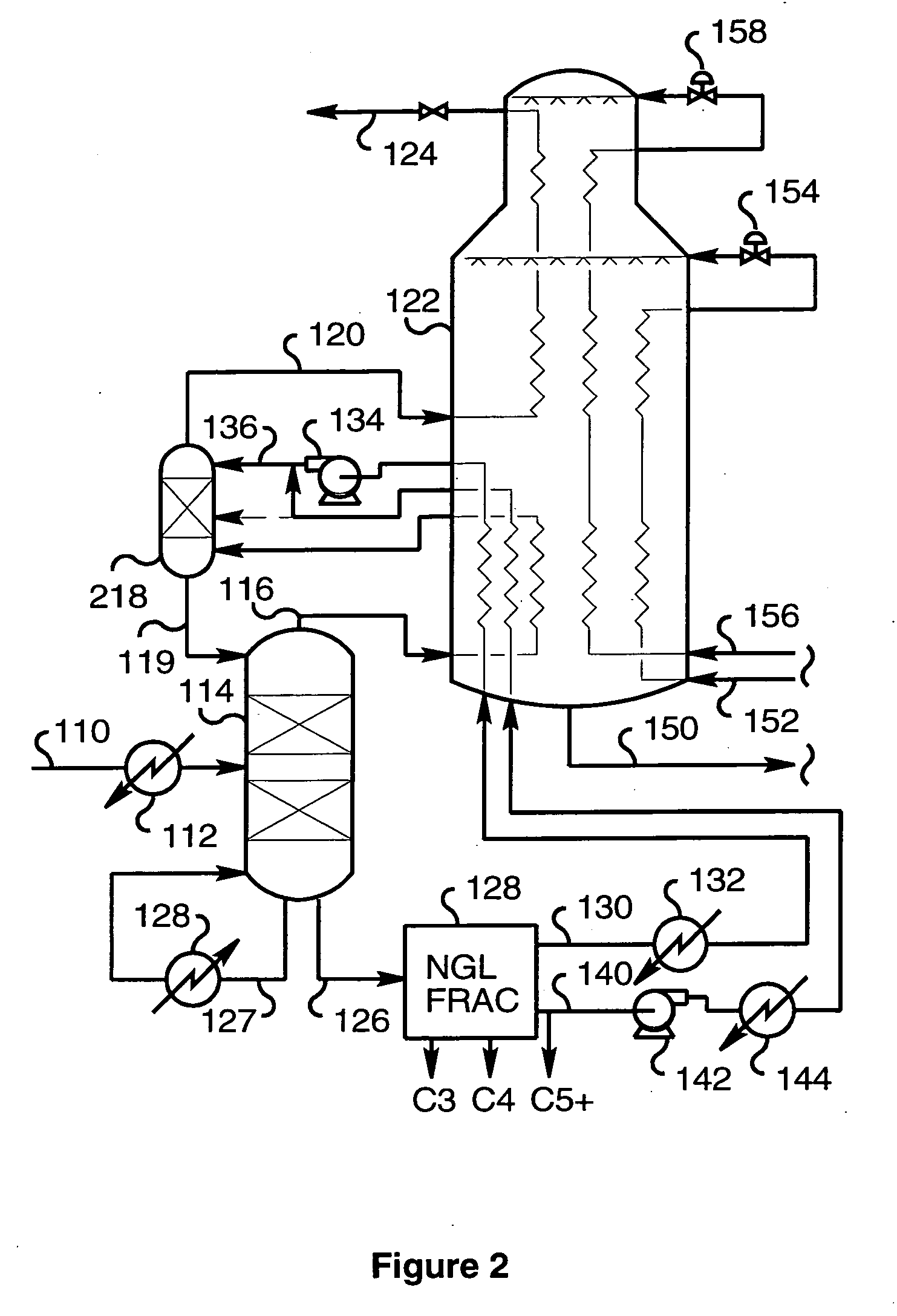

Integrated NGL recovery and liquefied natural gas production

InactiveUS20060260355A1Improves ethane-propane separationMaximize the benefitsSolidificationLiquefactionHydrocotyle bowlesioidesFractionation

The separation of methane from an admixture (110) with ethane and higher hydrocarbons, especially natural gas, using a scrub column (114), in which the admixture is separated into a methane-rich overhead (116) that is partially condensed (122) to provide reflux to the column (114) and liquid methane-depleted bottoms liquid (126), is improved by providing additional reflux (136) derived from an ethane enriched stream (130) from fractionation (128) of the bottoms liquid. Preferably, absorber liquid (140) from the fractionation (128) also is introduced into the scrub column. The vapor fraction (120) remaining after partial condensation can be liquefied (122) to provide LNG product (124).

Owner:AIR PROD & CHEM INC

Radio frequency identification pharmaceutical tracking system and method

InactiveUS7504954B2Quickly and efficiently be identifiedImprove Medication AdherenceRespiratorsData processing applicationsOrogastric tubeExcitation signal

Owner:SPAEDER JEFFREY A

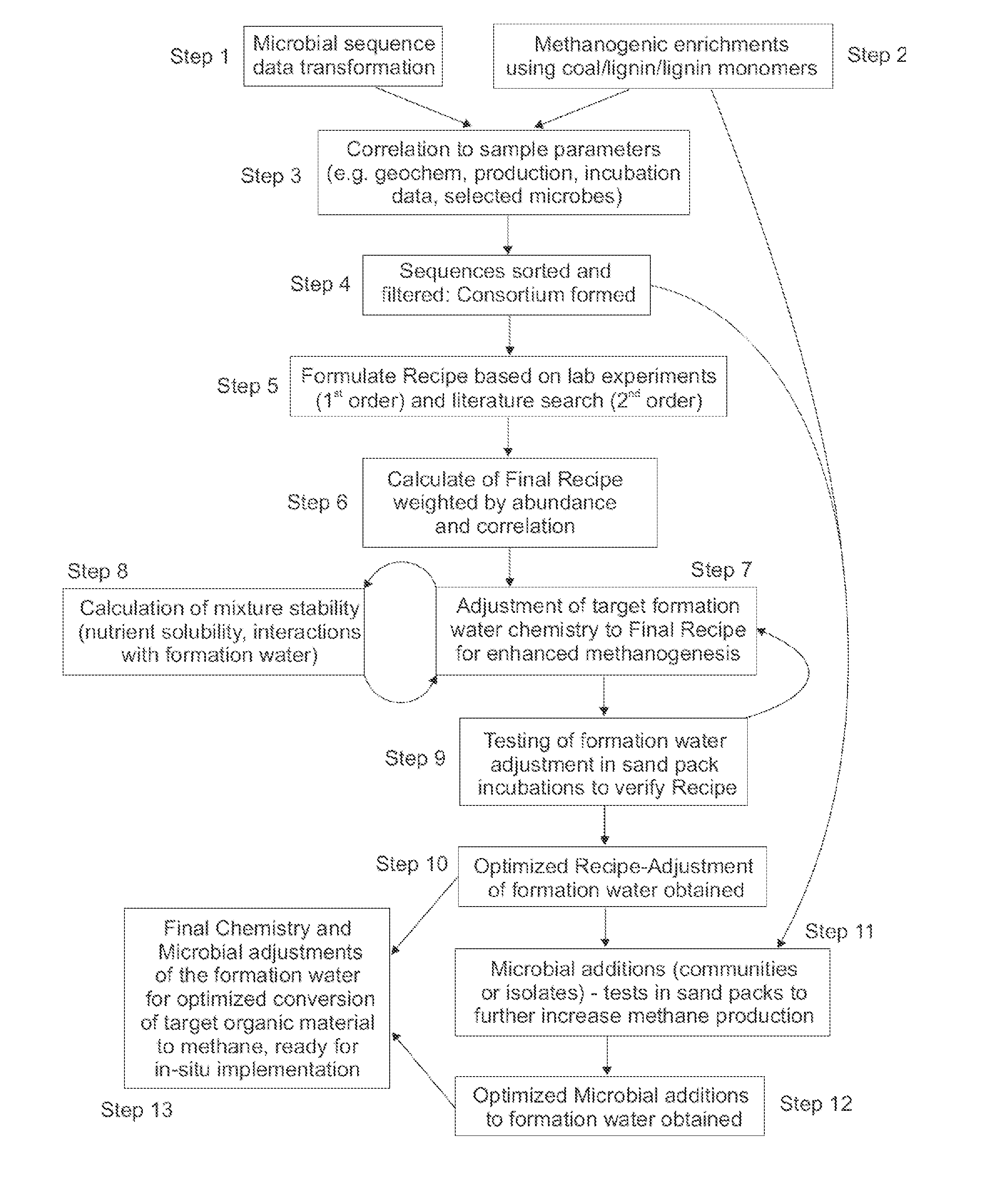

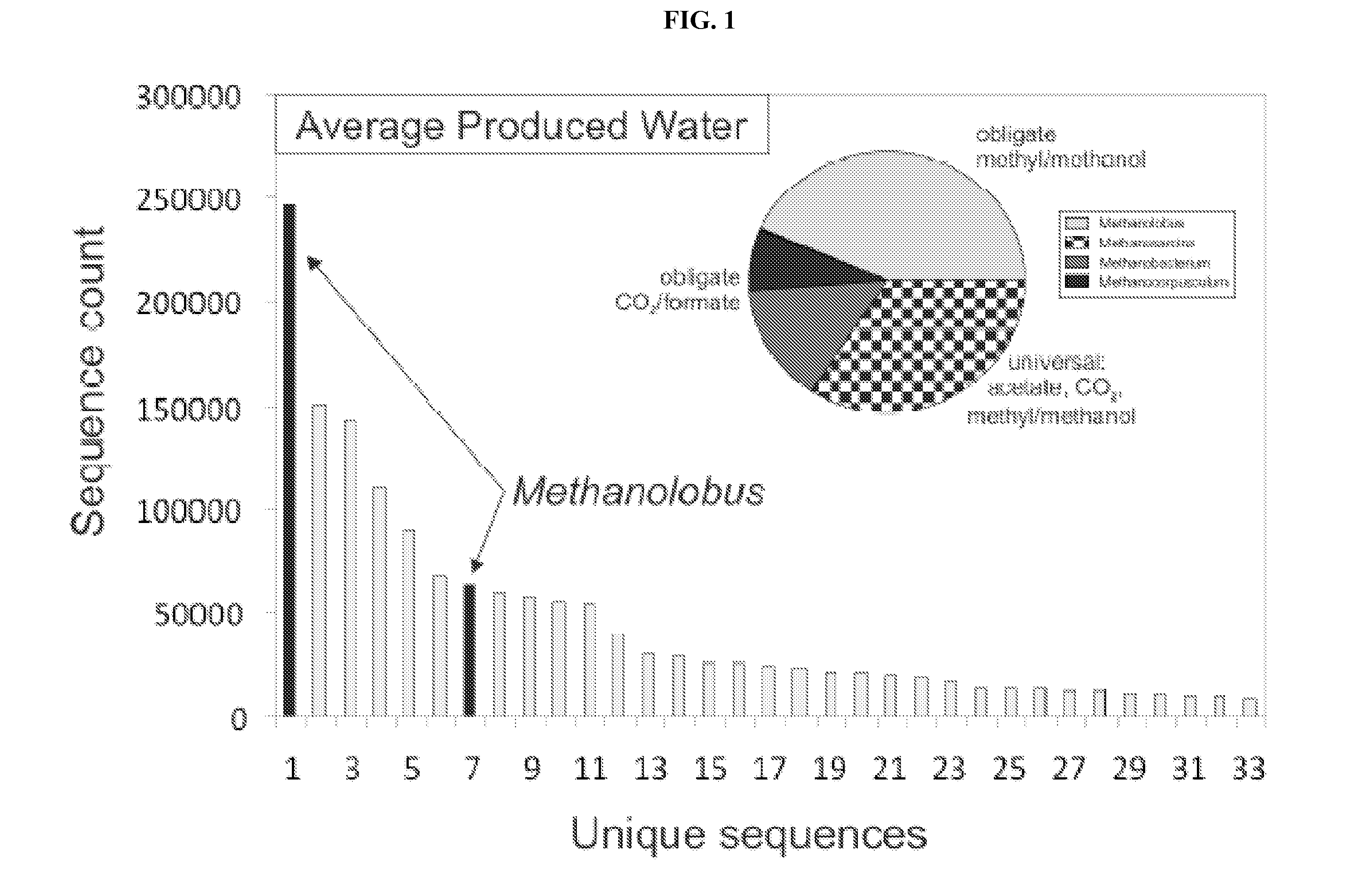

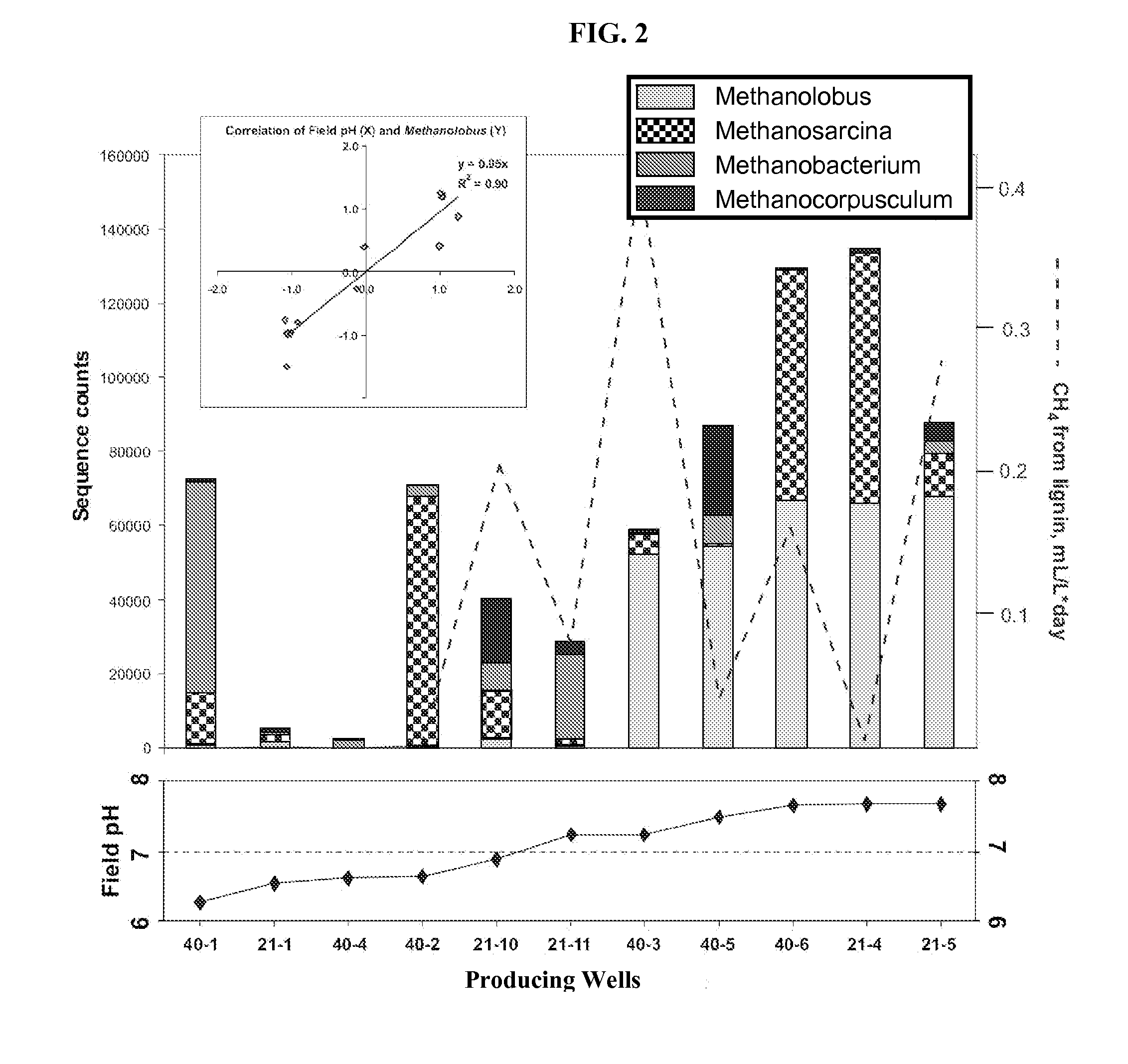

In situ methanogenesis modeling and risk analysis

ActiveUS20110308790A1Enhancing methanogenic rateEnhance methanogenic degradationSurveyBacteriaComputational modelMicrobiome

This invention generally relates to natural gas and methylotrophic energy generation, bio-generated fuels and microbiology. In alternative embodiments, the invention provides nutrient amendments and microbial compositions that are both specifically optimized to stimulate methanogenesis, or “methylotrophic” conversion. Additionally, the invention provides methods to develop nutrient amendments and microbial compositions that are both specifically optimized to stimulate methanogenesis in a given reservoir. The invention also provides methods for the evaluation of potentially damaging biomass formation and scale precipitation resulting from the addition of nutrient amendments. In another embodiment, the invention provides methods for simulating biogas in sub-surface conditions using a computational model.

Owner:CONOCOPHILLIPS CO

Kit for treating bony defects

InactiveUS20050131417A1Promote bone growthMaximize the benefitsInternal osteosythesisBone implantFilling materialsBone defect

Owner:SPINEOLOGY +1

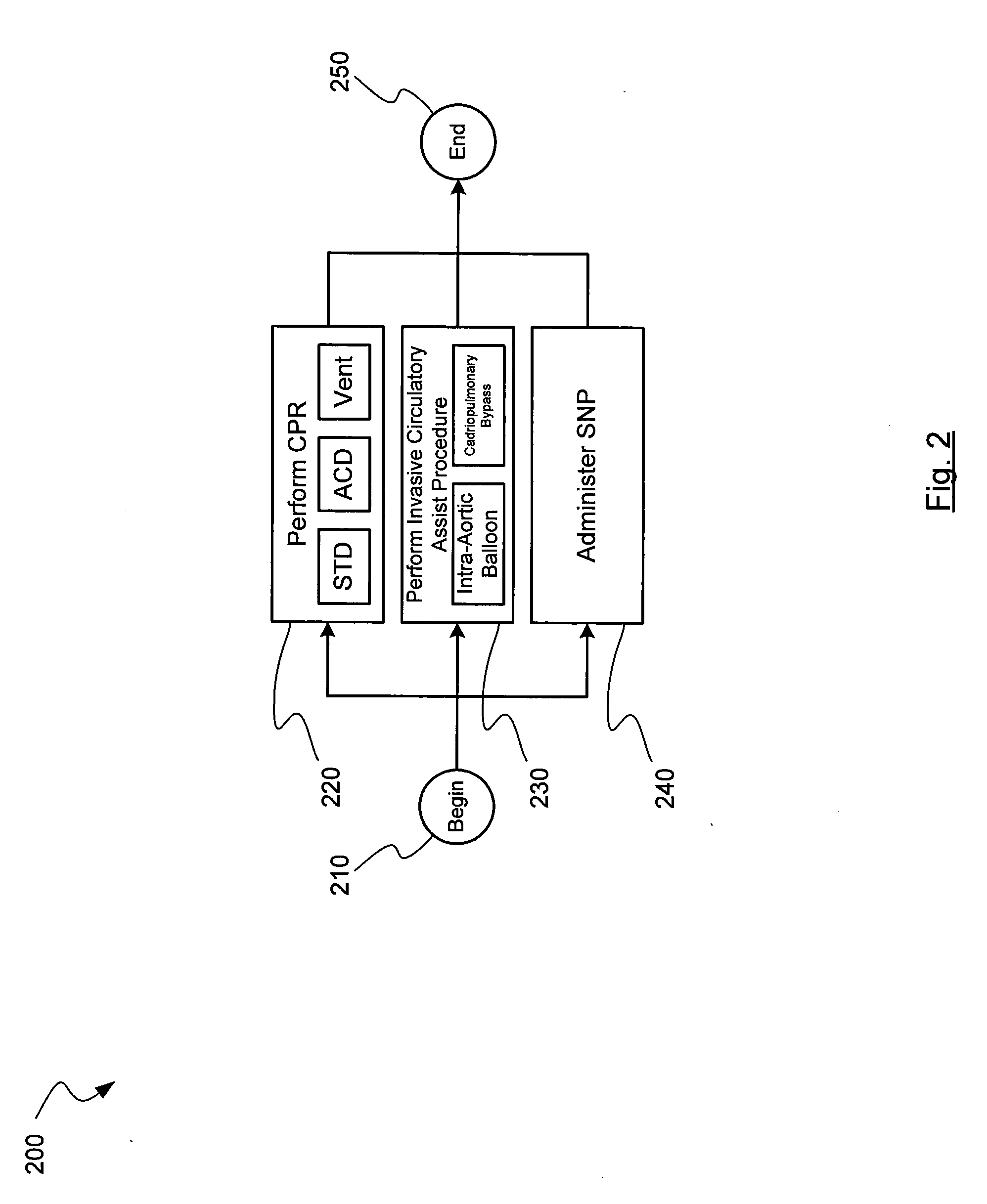

Vasodilator-enhanced cardiopulmonary resuscitation

InactiveUS20120203147A1Increase blood flowImprove artificial circulationBiocideHeavy metal active ingredientsImpedance threshold deviceVascular dilatation

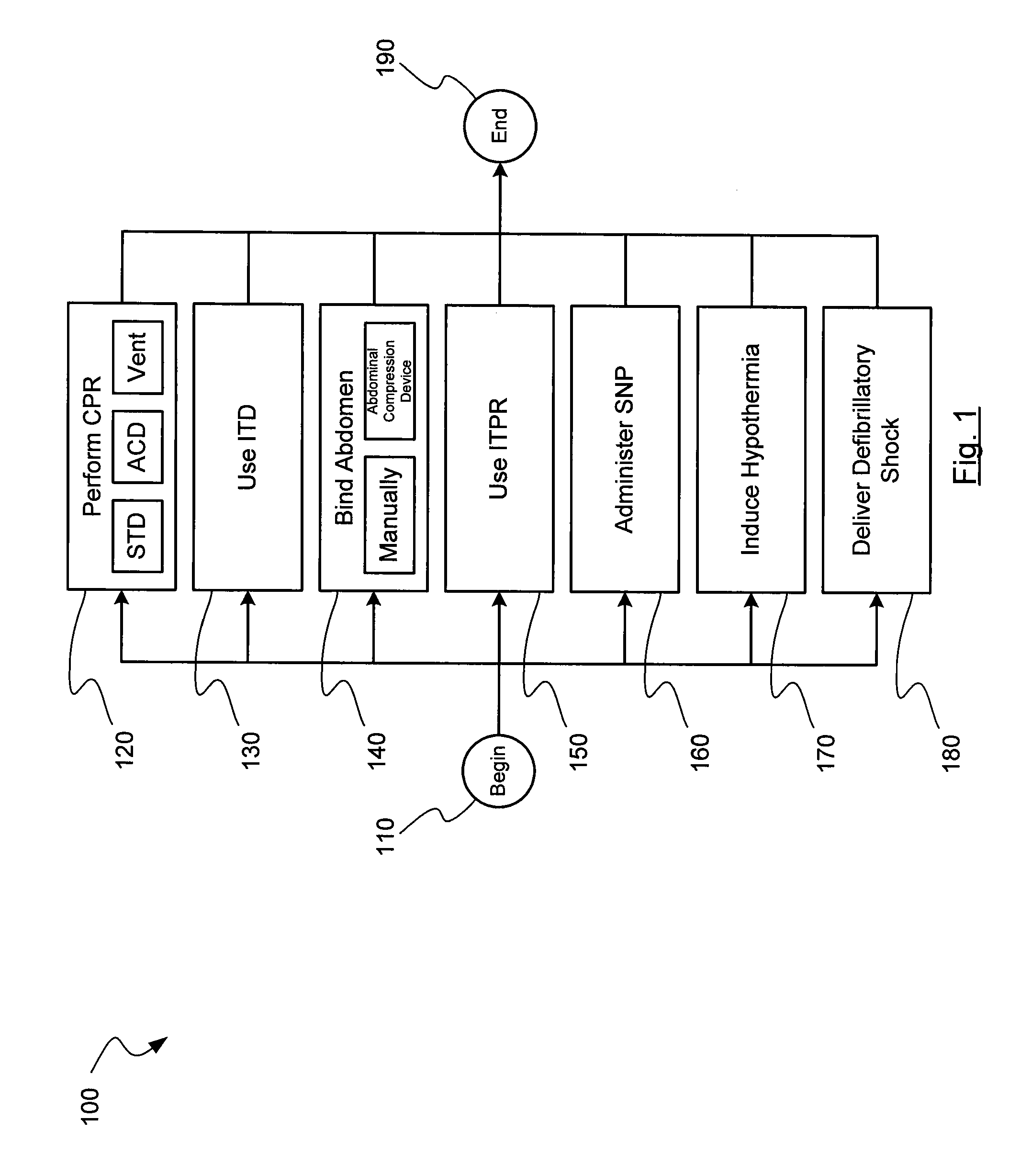

A method for increasing blood flow to vital organs during cardiopulmonary resuscitation of a person experiencing a cardiac arrest may include performing standard or active compression decompression cardiopulmonary resuscitation on a person to create artificial circulation by repetitively compressing the person's chest such that the person's chest is subject to a compression phase and a relaxation or decompression phase. The method may also include administering one or more vasodilator drugs to the person to improve the artificial circulation created by the cardiopulmonary resuscitation. The method may also include binding at least a portion of the person's abdomen, either manually or with an abdominal compression device. Performing cardiopulmonary resuscitation on a person may include ventilating the person with either an impedance threshold device or a intrathoracic pressure regulator.

Owner:ZOLL MEDICAL CORPORATION

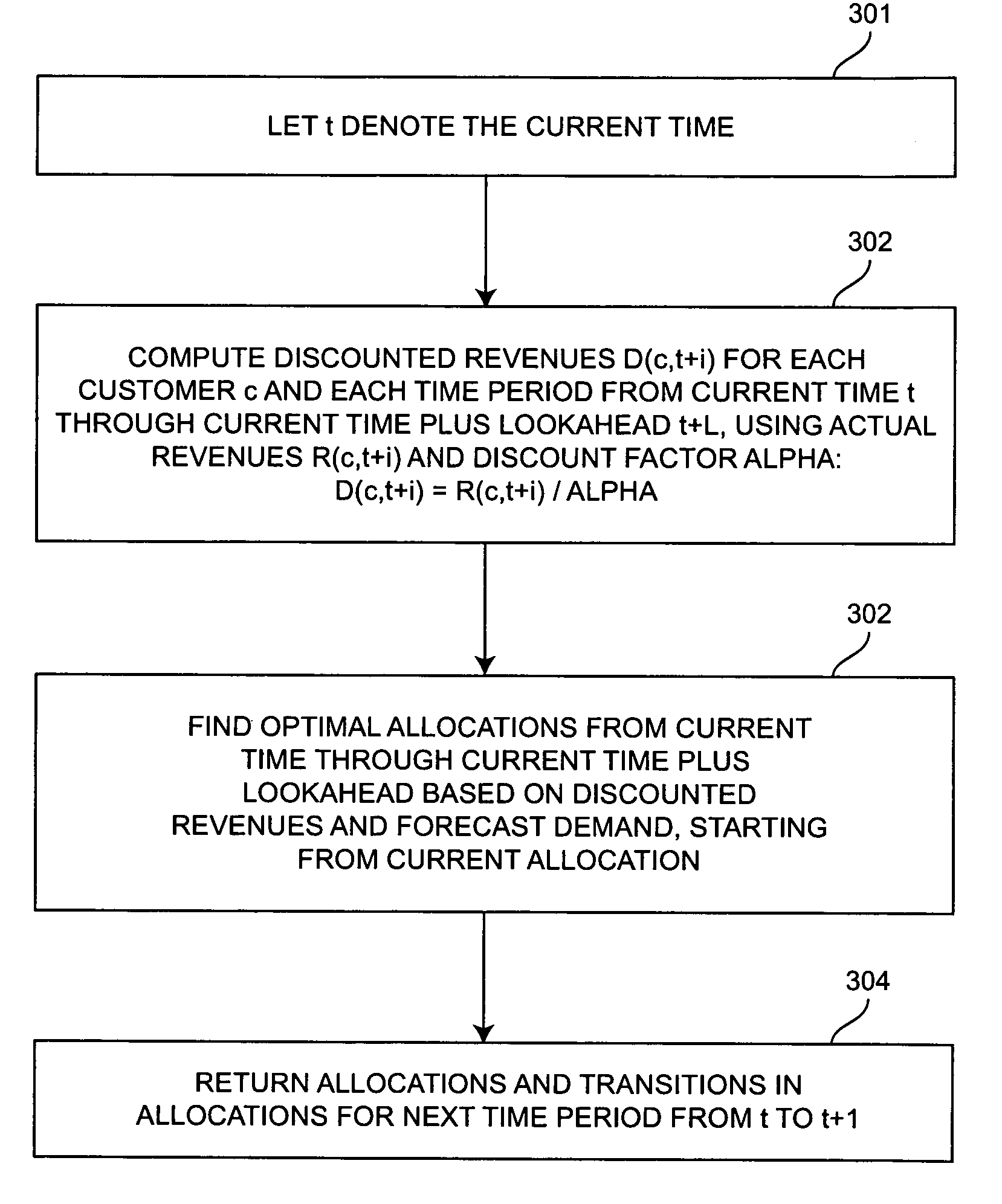

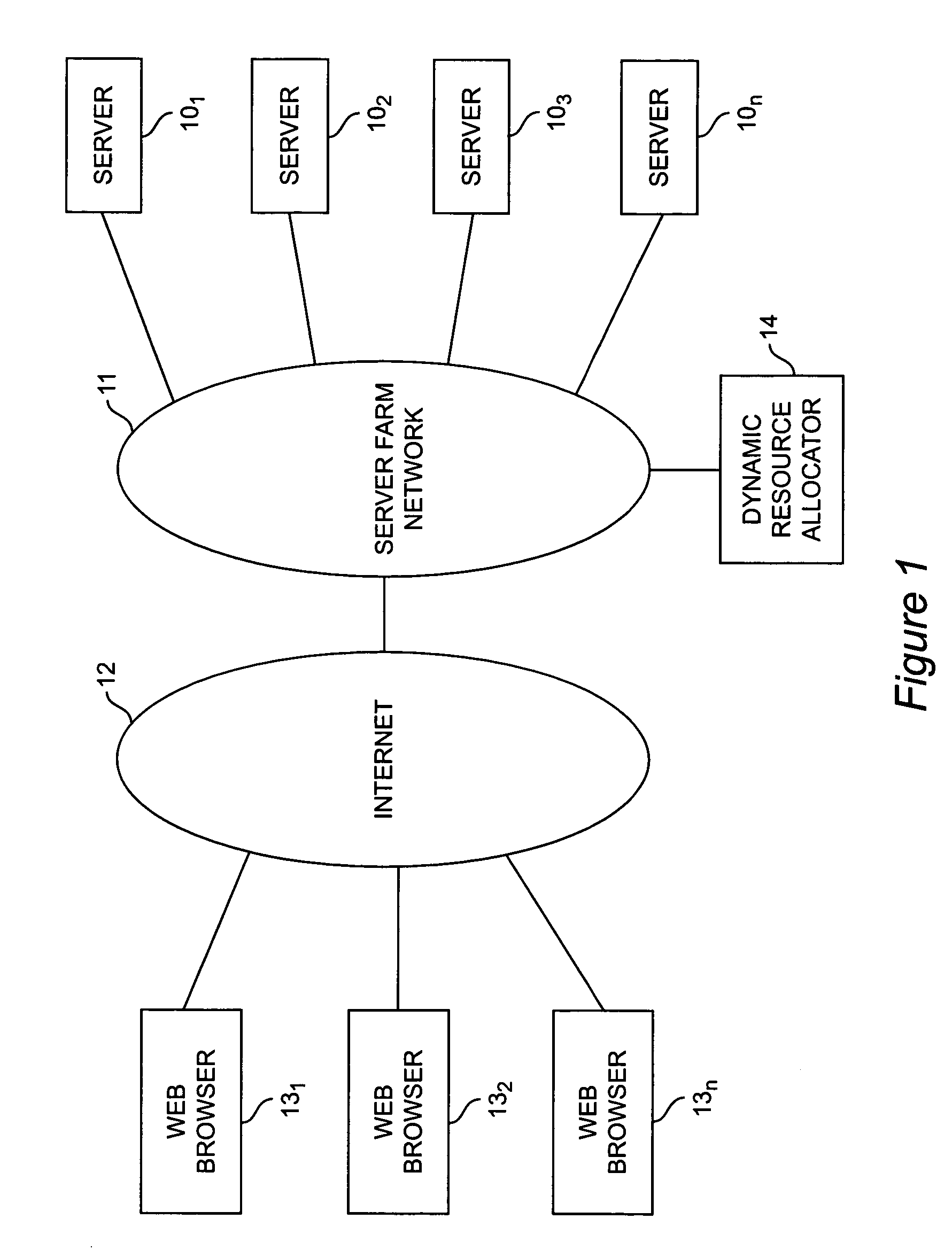

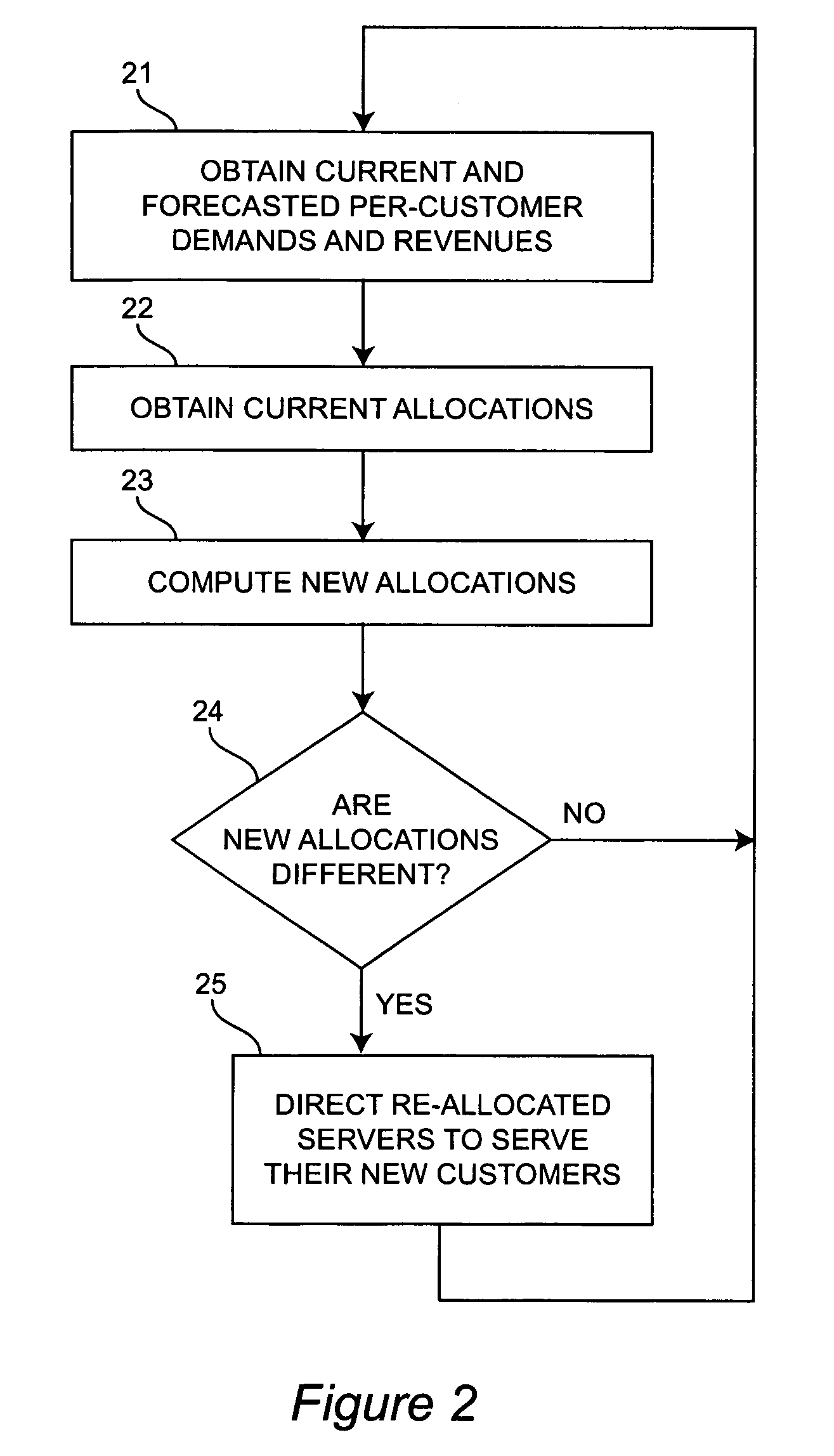

Dynamic resource allocation using projected future benefits

InactiveUS7308415B2Maximize the benefitsImprove solution qualityResource allocationDigital computer detailsWeb serviceDynamic resource

A method for server allocation in a Web server “farm” is based on limited information regarding future loads to achieve close to the greatest possible revenue based on the assumption that revenue is proportional to the utilization of servers and differentiated by customer class. The method of server allocation uses an approach of “discounting the future”. Specifically, when the policy faces the choice between a guaranteed benefit immediately and a potential benefit in the future, the decision is made by comparing the guaranteed benefit value with a discounted value of the potential future benefit. This discount factor is exponential in the number of time units that it would take a potential benefit to be materialized. The future benefits are discounted because by the time a benefit will be materialized, things might change and the algorithm might decide to make another choice for a potential (even greater) benefit.

Owner:INT BUSINESS MASCH CORP

Emulsion particles as reinforcing fillers

InactiveUS6780937B2Great tractionIncrease in the tangent deltaLaminationLamination apparatusPolymer scienceEmulsion

Owner:THE GOODYEAR TIRE & RUBBER CO

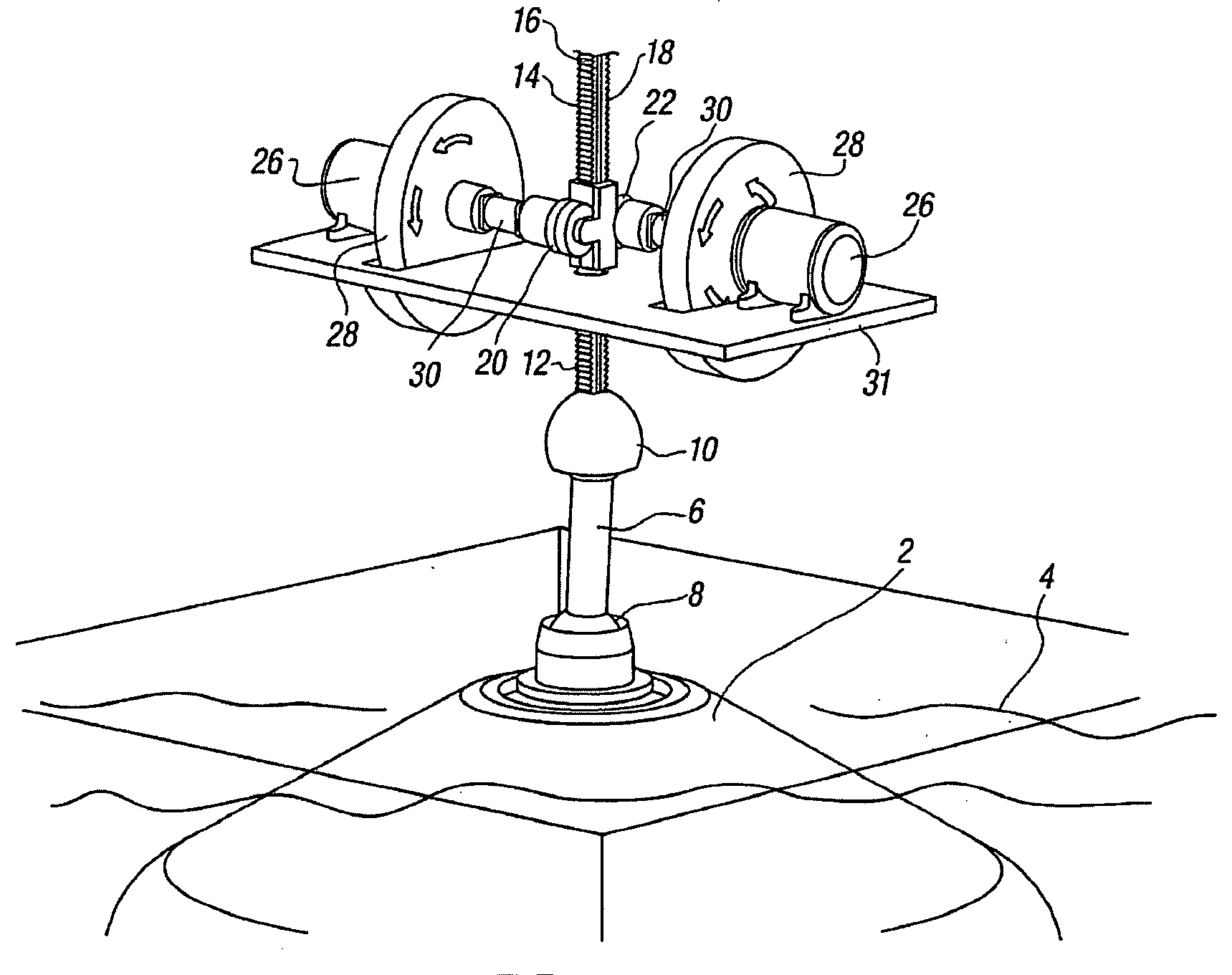

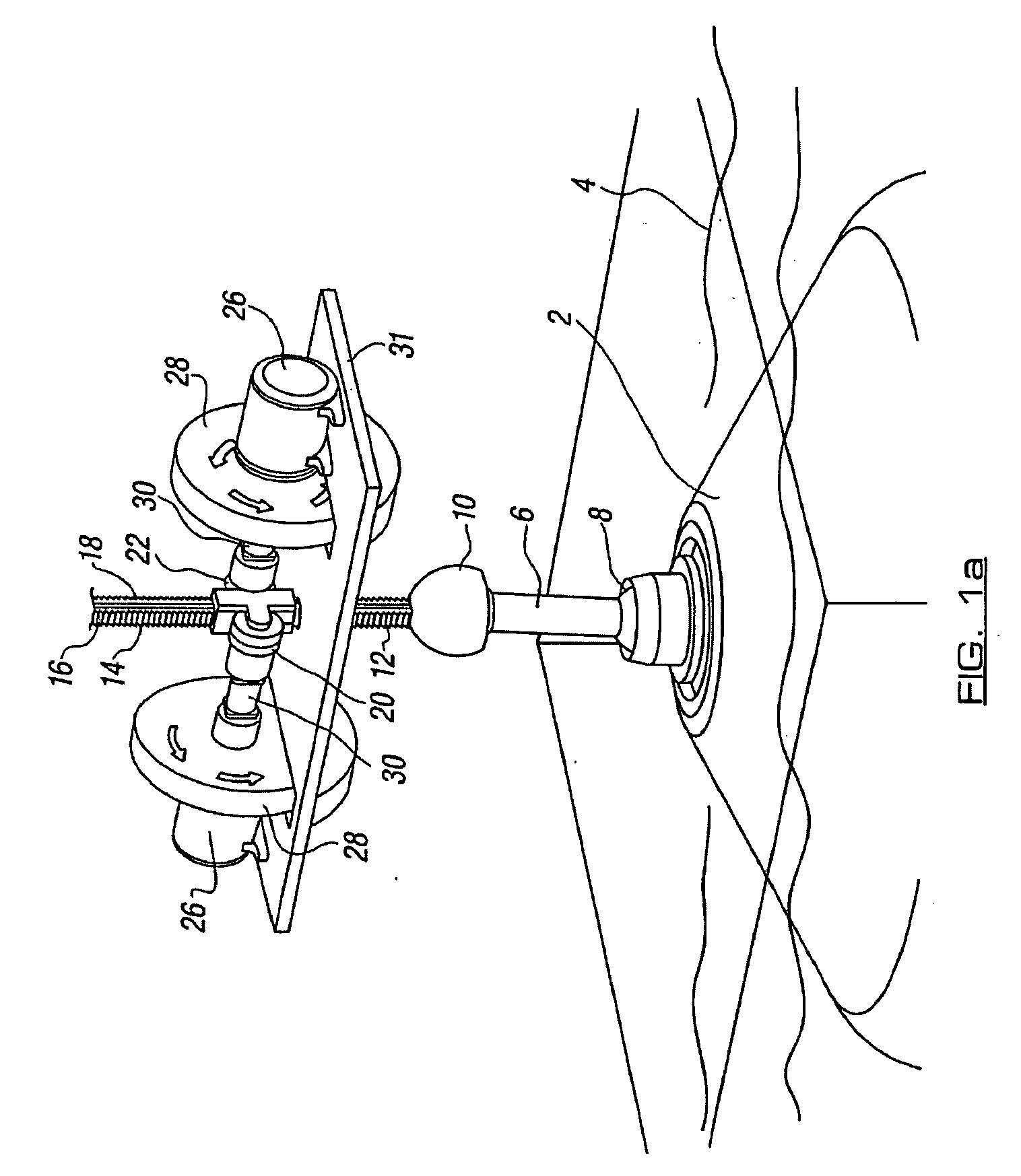

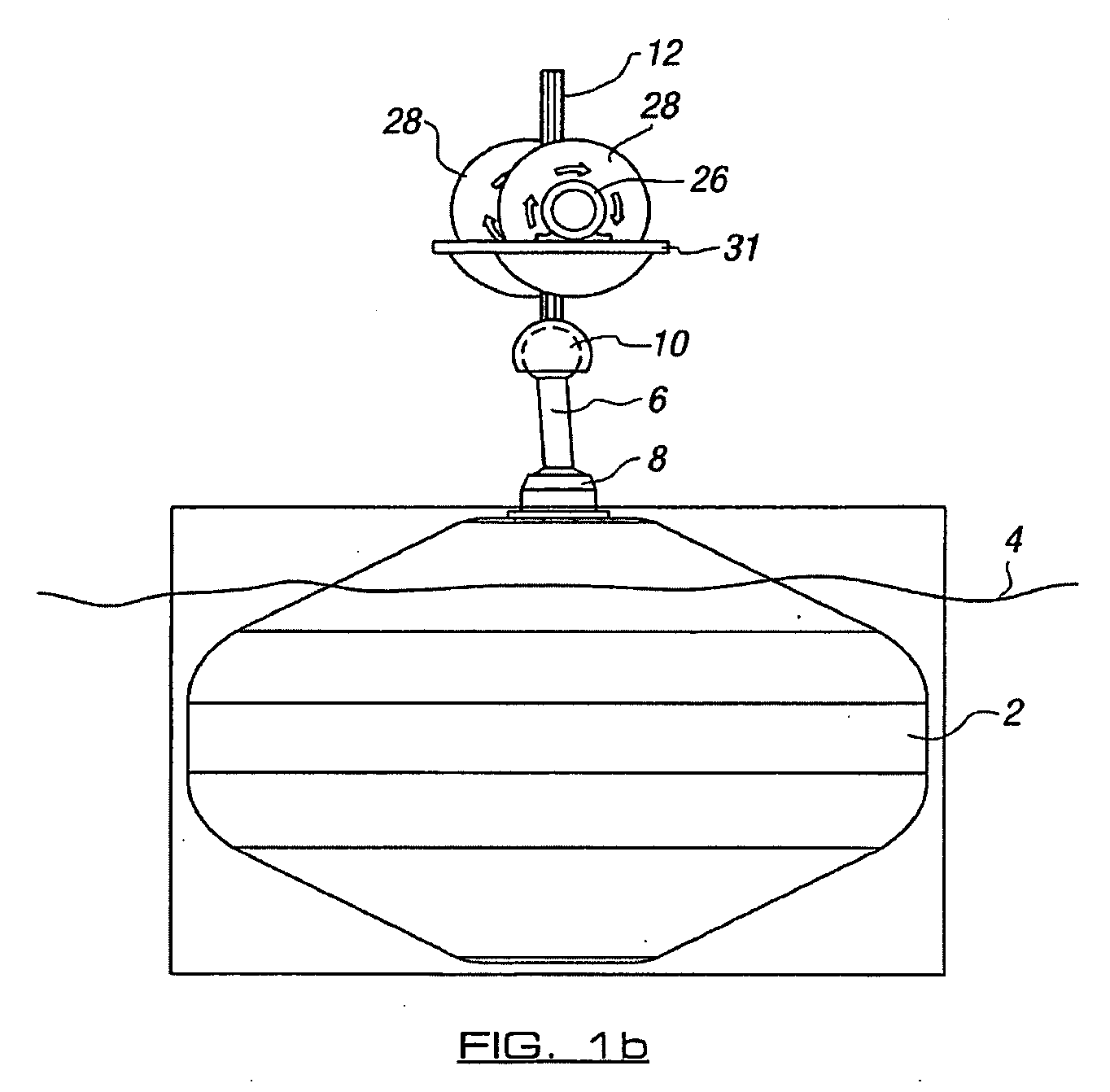

Movement and power generation apparatus

InactiveUS20090072540A1Increased revolutionMaximize the benefitsMachines/enginesEngine componentsEngineeringElectric generator

The invention relates to apparatus which allows the movement of a body of water, such as that created by waves and / or a swell in the sea, to be utilized to generate power. The apparatus includes a first member in the form of a float, which is connected to a second member and at least one rotatable means connected to a power generator. In one embodiment the second member is connected with and supported on the first member while the rotatable member and power generator are provided at a relatively fixed location and coupled to second member such that relative movement of the second member with respect to the rotatable means is used to cause the generation of power.

Owner:MCCAGUE JAMES +1

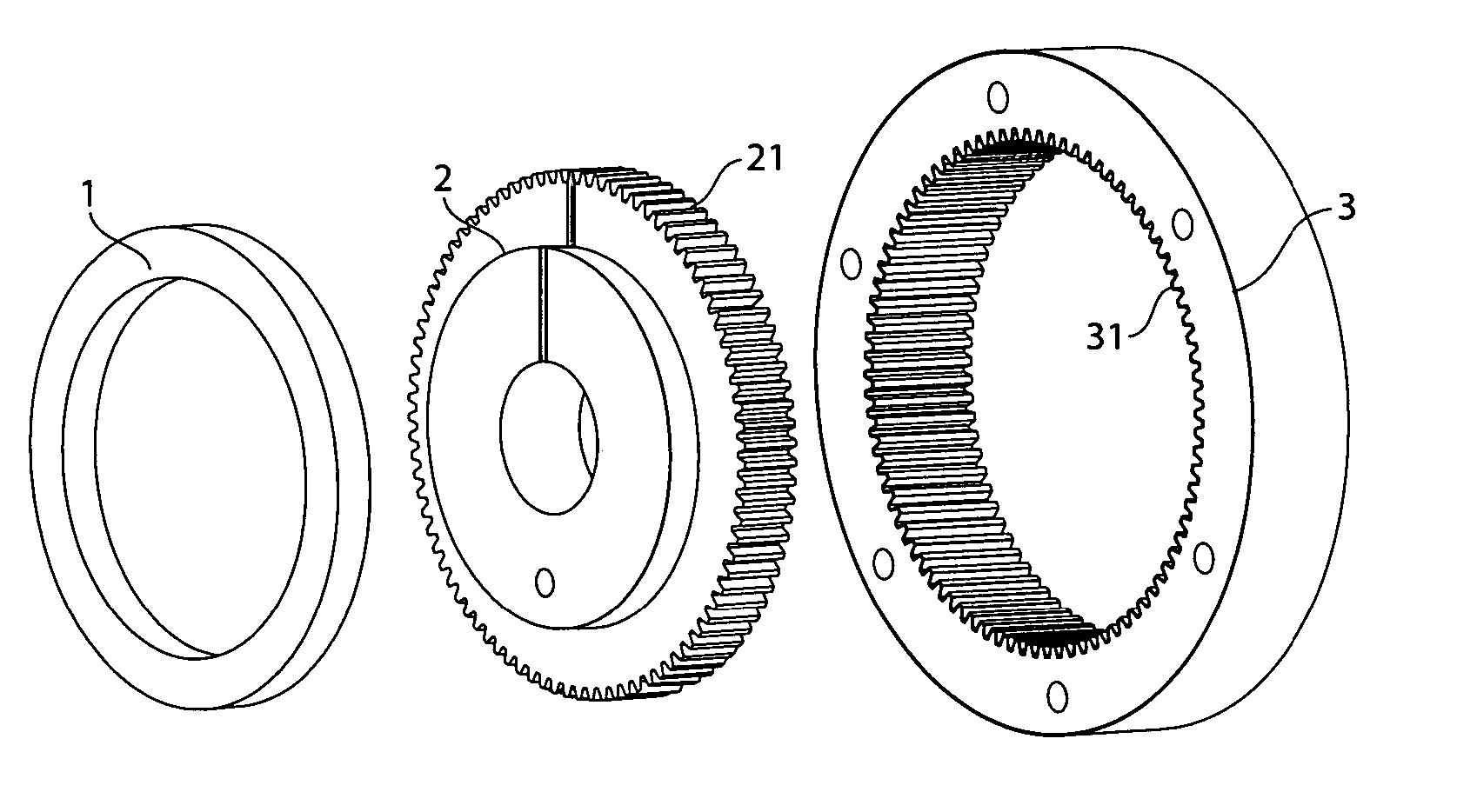

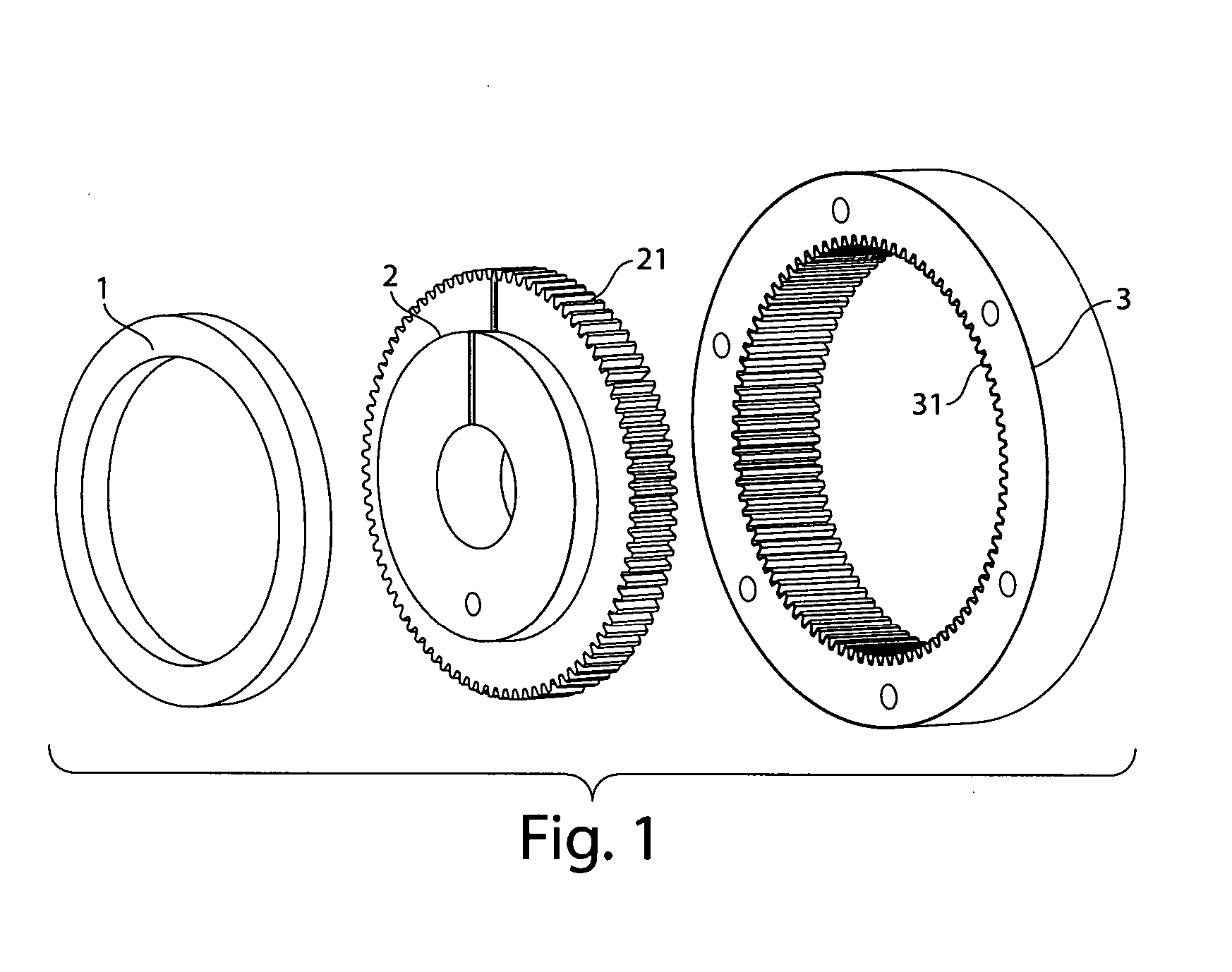

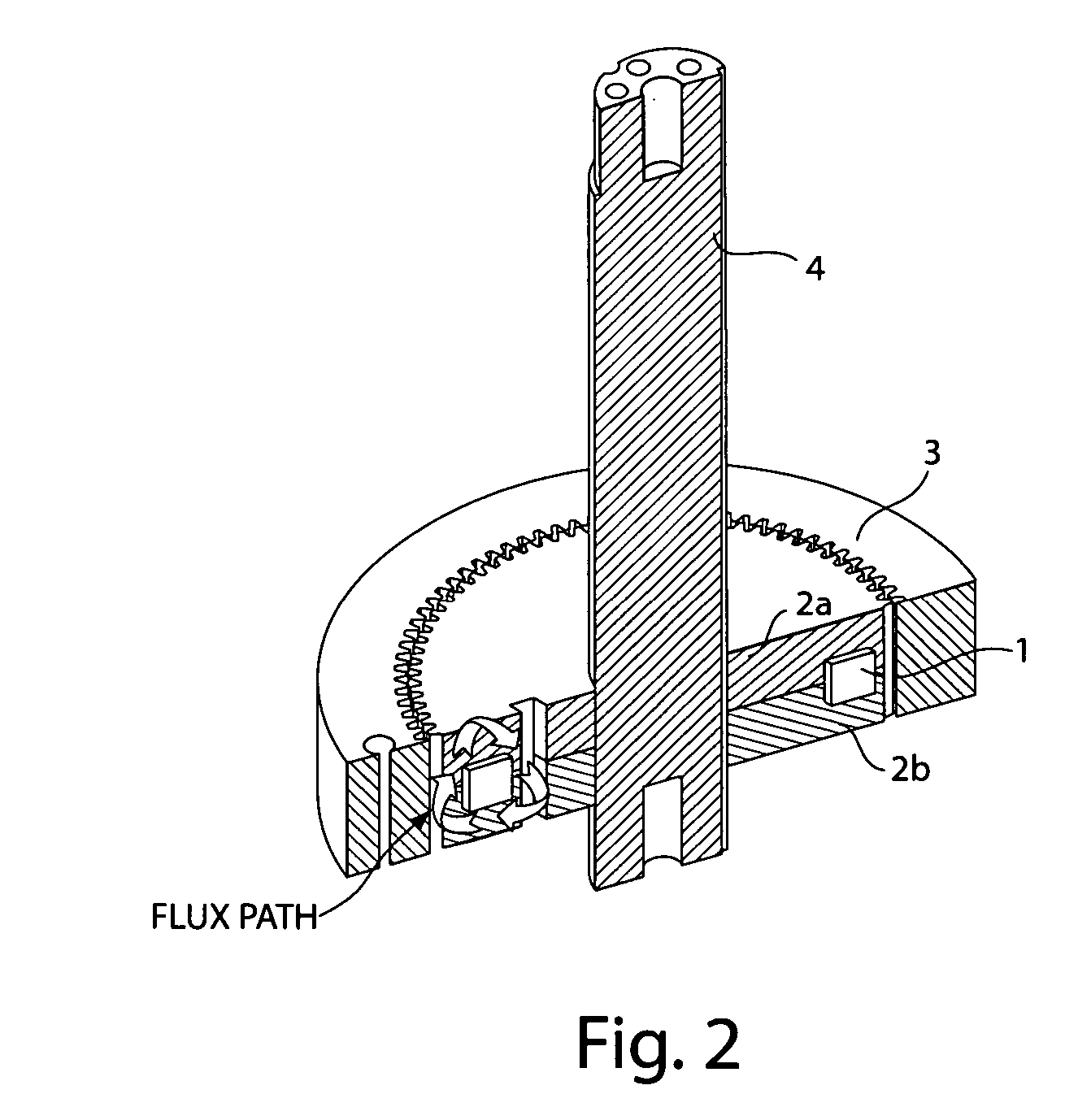

Transverse flux switched reluctance motor and control methods

InactiveUS20060091755A1Eliminate end turn lossHigh densitySynchronous generatorsElectronic commutation motor controlTransverse fluxElectric machine

A variable reluctance motor and methods for control. The motor may include N motor phases, where N equals three or more. Each motor phase may include a coil to generate a magnetic flux, a stator and a rotor. A flux-carrying element for the rotor and / or stator may be made entirely of SMC. The stators and rotors of the N motor phases may be arranged relative to each other so that when the stator and rotor teeth of a selected phase are aligned, the stator and rotor teeth in each of the other motor phases are offset from each other, e.g., by an integer multiple of 1 / N of a pitch of the stator or rotor teeth. A fill factor of the coil relative to the space in which it is housed may be at least 60%, and up to 90% or more. The stator and rotor flux-carrying elements together may include at most three separable parts.

Owner:PRECISE AUTOMATION

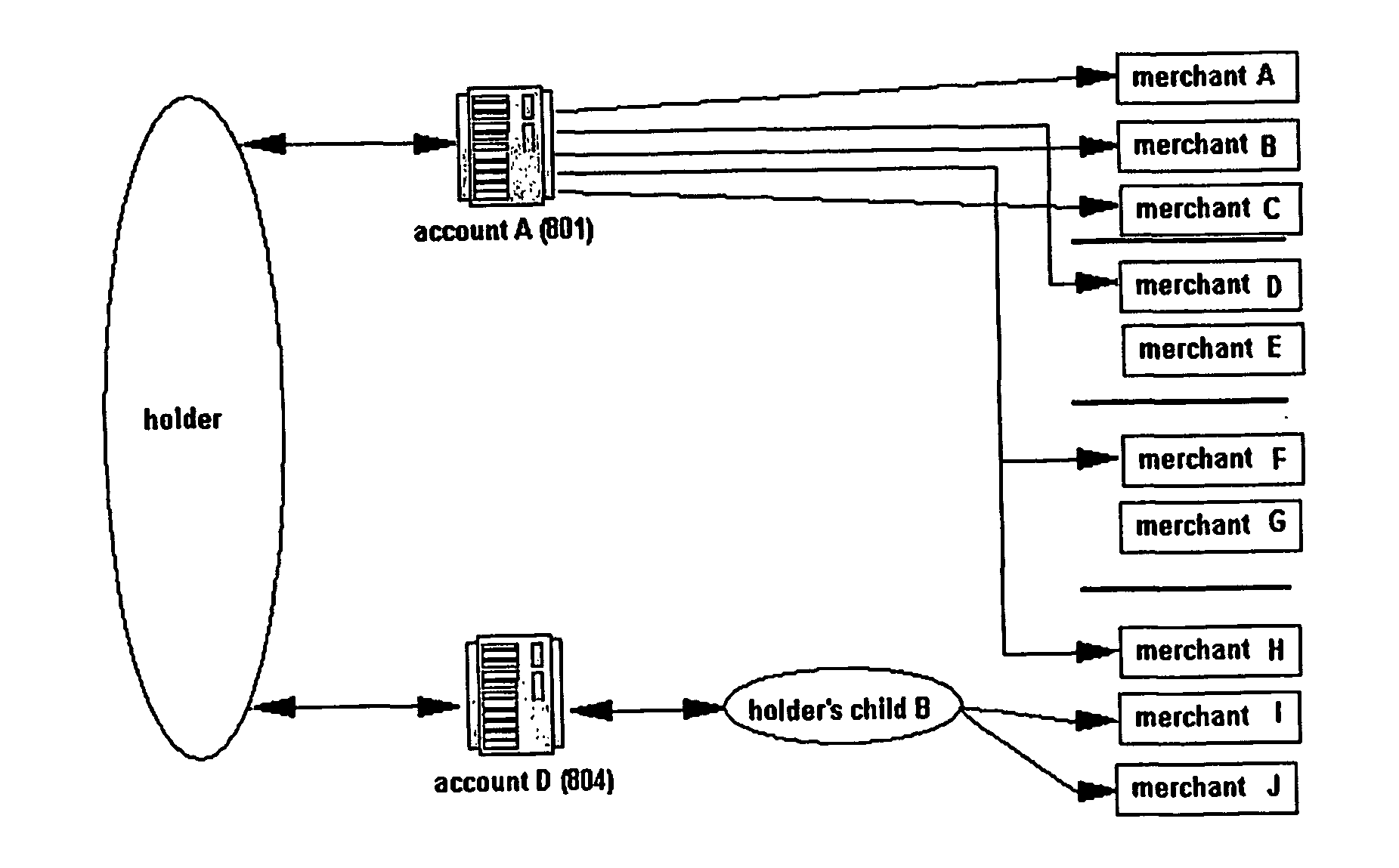

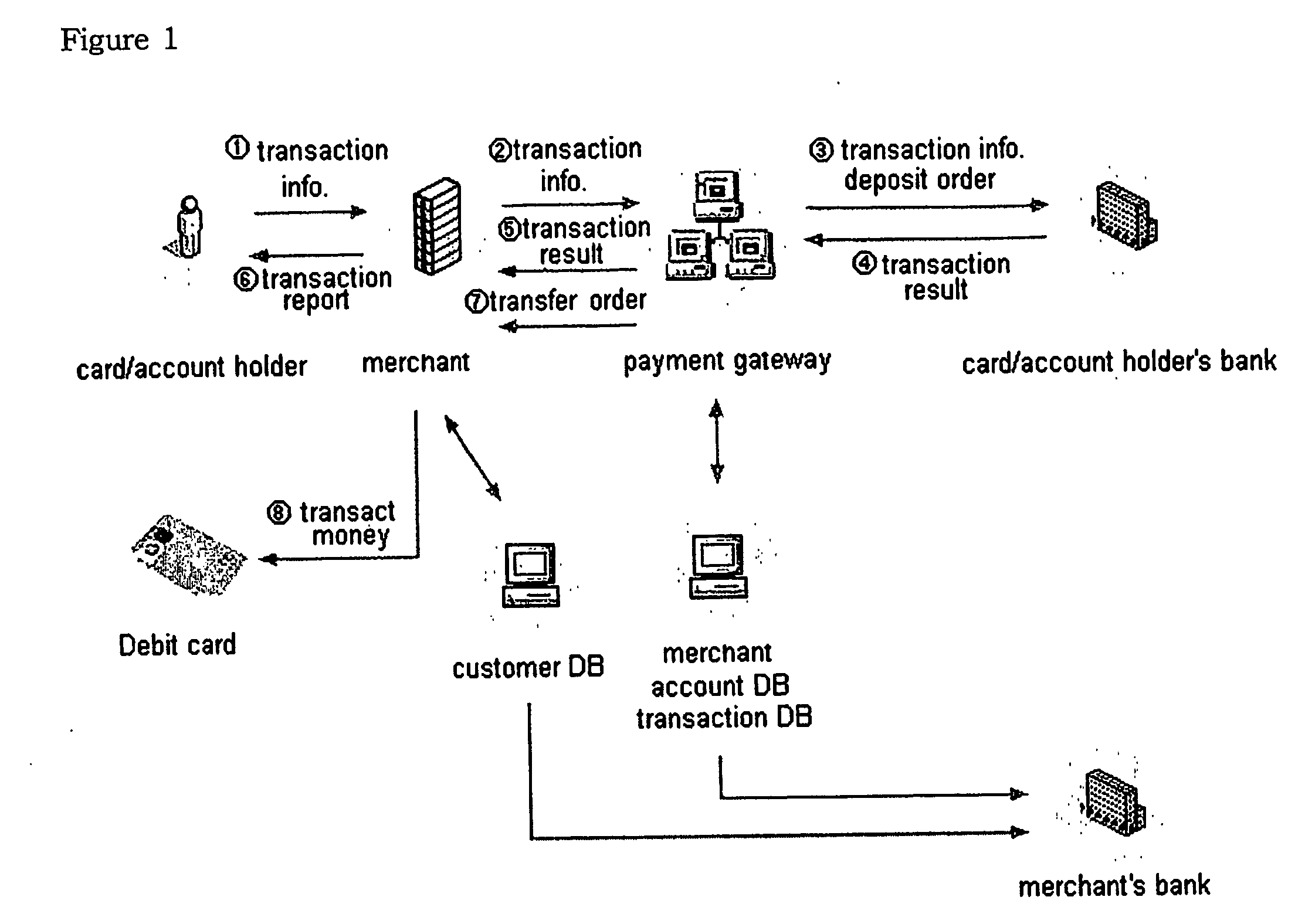

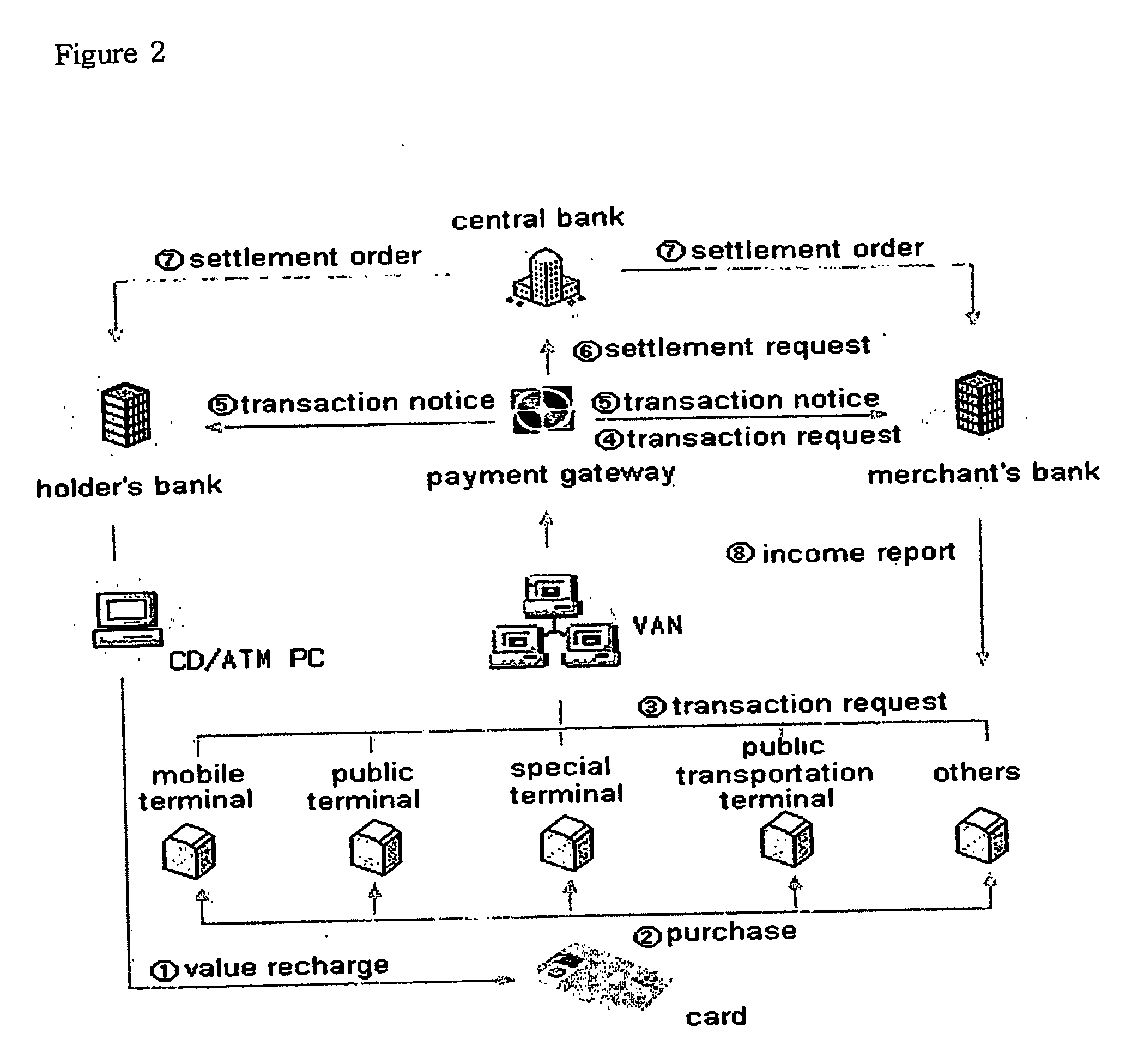

Bank transaction method linking accounts via common accounts

InactiveUS20070130062A1Solve the inconvenienceMaximize the benefitsComplete banking machinesFinanceFinancial transactionData format

The present invention discloses a bank transaction method linking accounts via common accounts, wherein the existing accounts of the account holder and / or newly opened plural accounts link arbitrarily as defined by the account holder for convenient transactions between account holder's primary account and other's secondary accounts without using account numbers of the concerned accounts. To fulfill, the purpose, the present invention enables the account holder to make transactions on a primary account as well on linked secondary accounts in real time; and the said primary and secondary accounts are also offered for independent transaction as ordinary bank accounts. In addition, the classification and management of the said primary and secondary accounts are attainable through the individual account number with specified account code given by the bank to achieve transactions between the said primary and secondary accounts while implementing the conventional banking system. Furthermore, transaction to the external transaction network including payment gateway can be processed without changing the existing data format, both of account holders' and bank's convenience is maximized.

Owner:HUH INGHOO

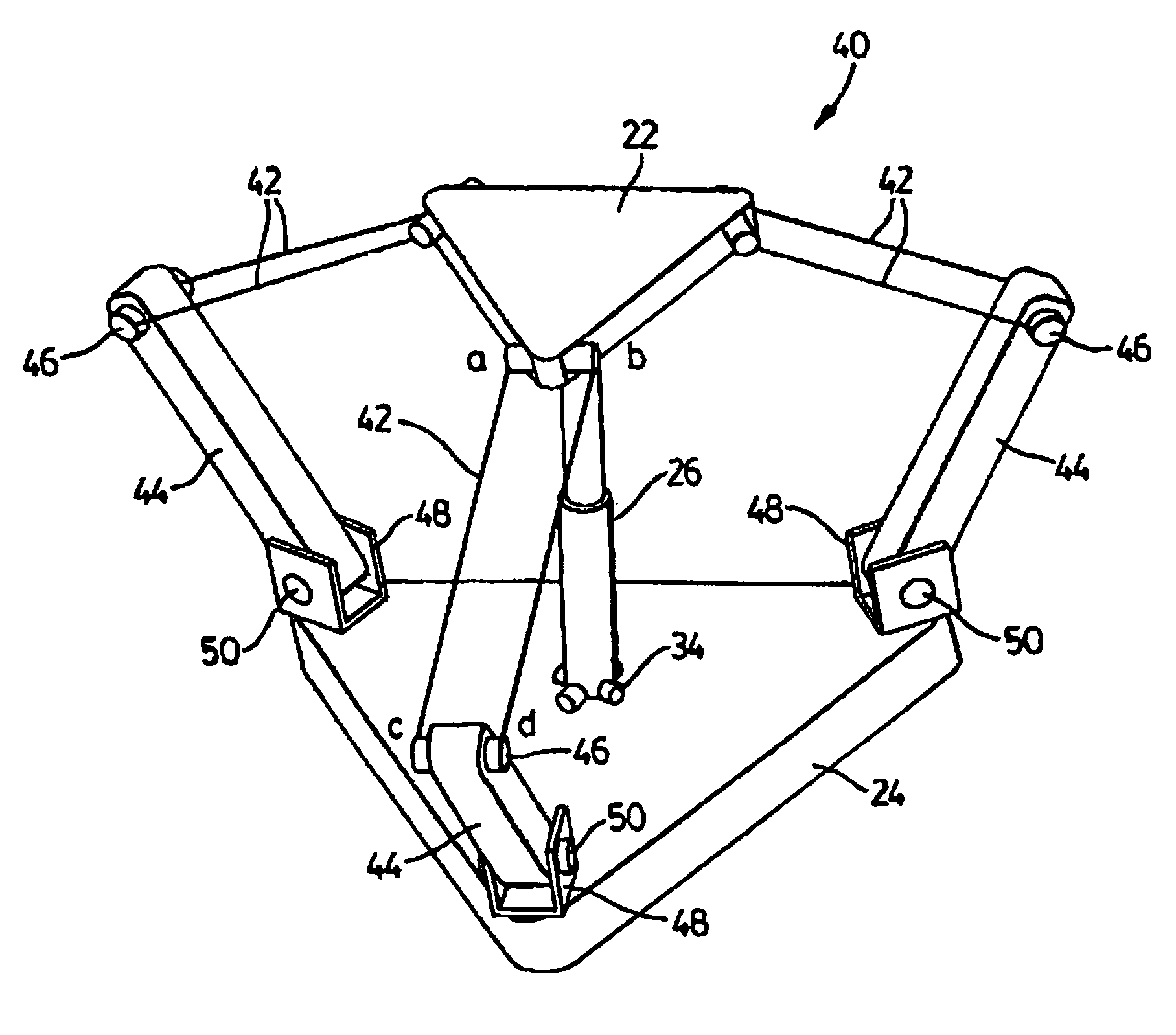

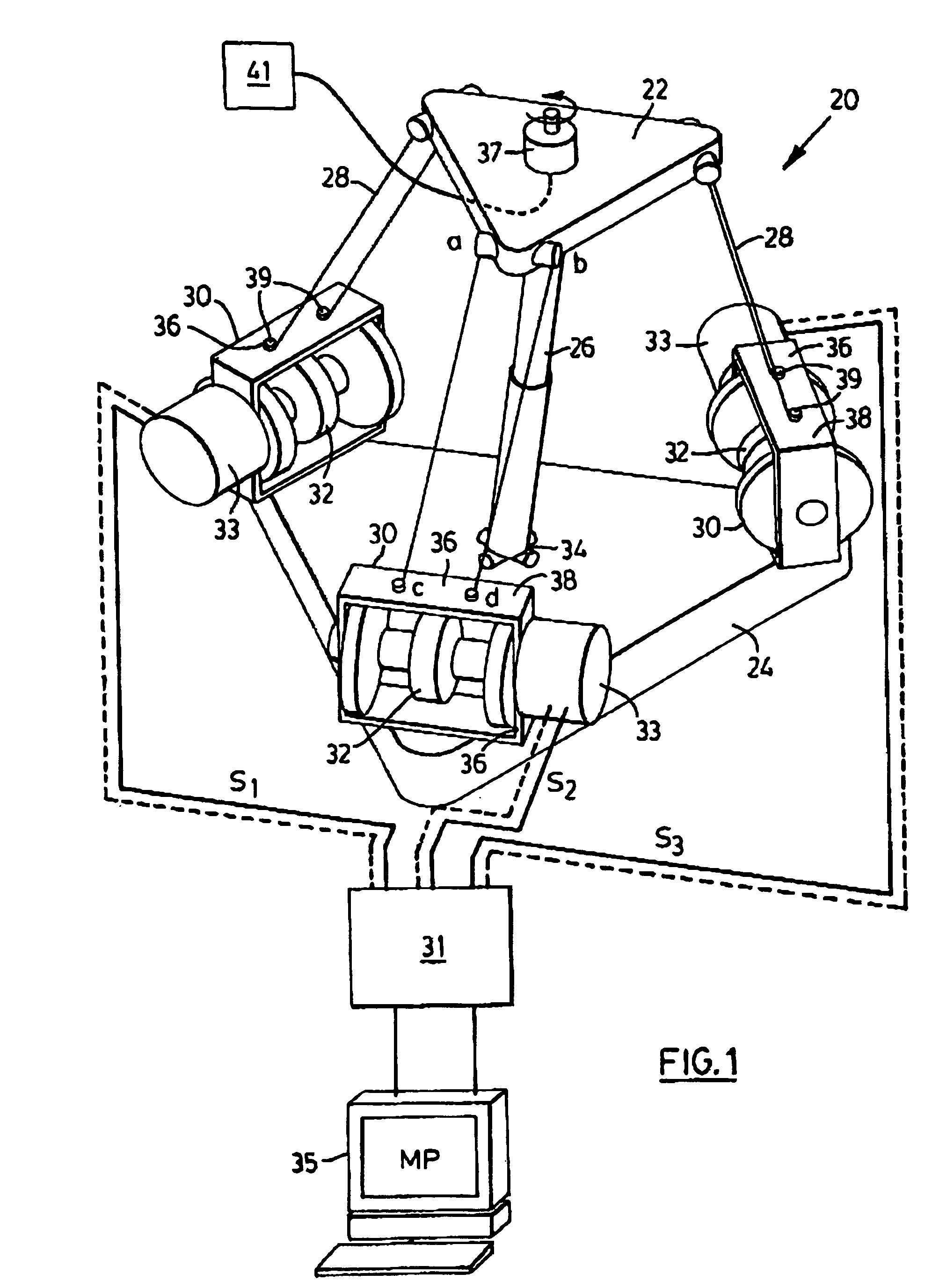

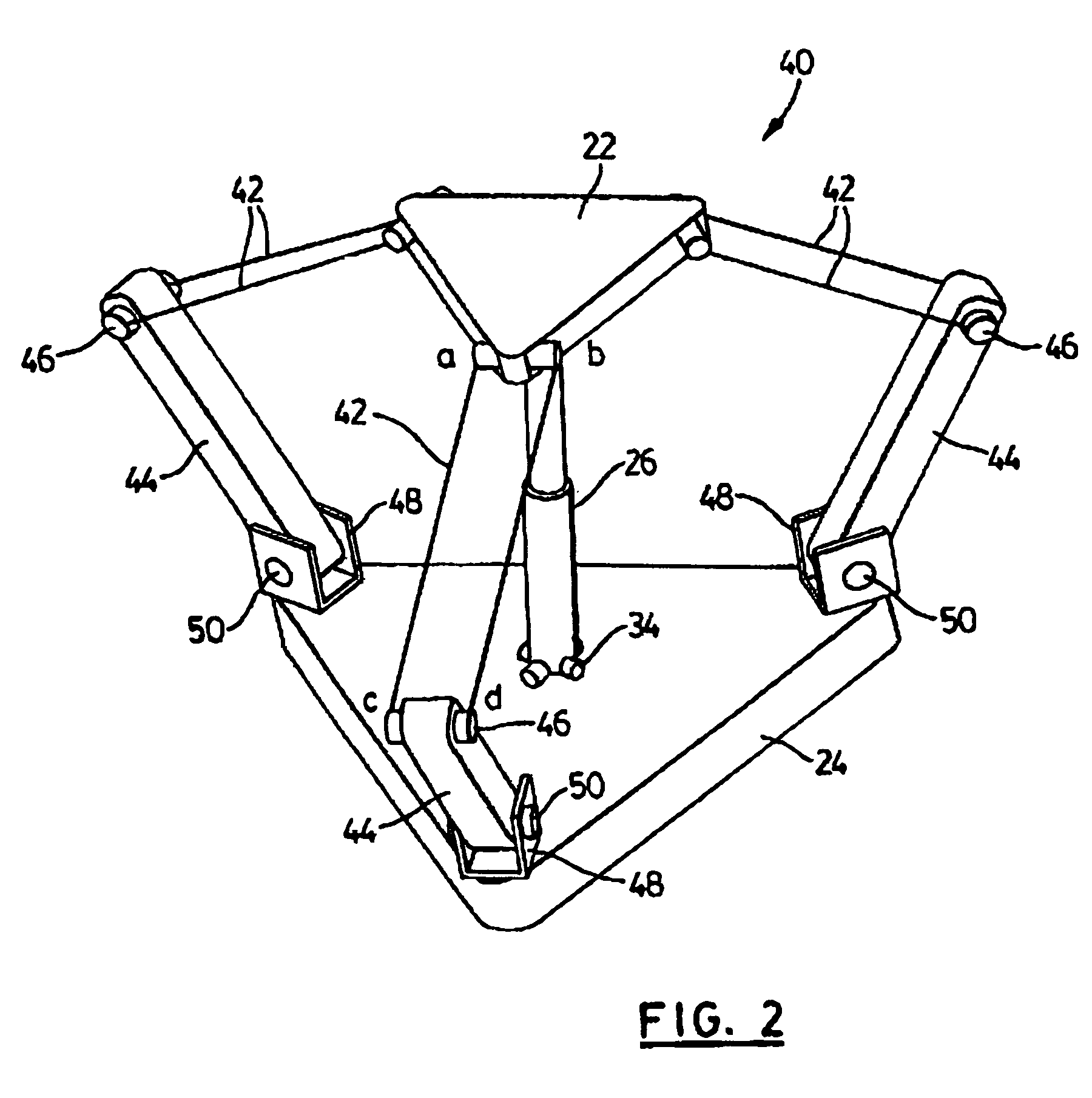

Light weight parallel manipulators using active/passive cables

ActiveUS7172385B2Simple processMaximize the benefitsProgramme-controlled manipulatorMechanical apparatusUltra high speedCost effectiveness

The present invention provides parallel, cable based robotic manipulators, for use in different applications such as ultra high-speed robots or positioning devices with between three to six degrees of freedom. The manipulators provide more options for the number of degrees of freedom and also more simplicity compared to the current cable-based robots. The general structure of these manipulators includes a base platform, a moving platform or end effector, an extensible or telescoping central post connecting the base to moving platform to apply a pushing force to the platforms. The central post can apply the force by an actuator (active), or spring or air pressure (passive) using telescoping cylinders. The robotic manipulators use a combination of active and passive tensile (cable) members, and collapsible and rigid links to maximize the benefits of both pure cable and conventional parallel mechanisms. Different embodiments of the robotic manipulators use either active cables only, passive cables only, or combinations of active and passive cables. An active cable is one whose length is varied by means of a winch. A passive cable is one whose length is constant and which is used to provide a mechanical constraint. These mechanisms reduce the moving inertia significantly to enhance the operational speed of the robots. They also provide a simpler, more cost effective way to manufacture parallel mechanisms for use in robotic applications.

Owner:KHAJEPOUR AMIR +3

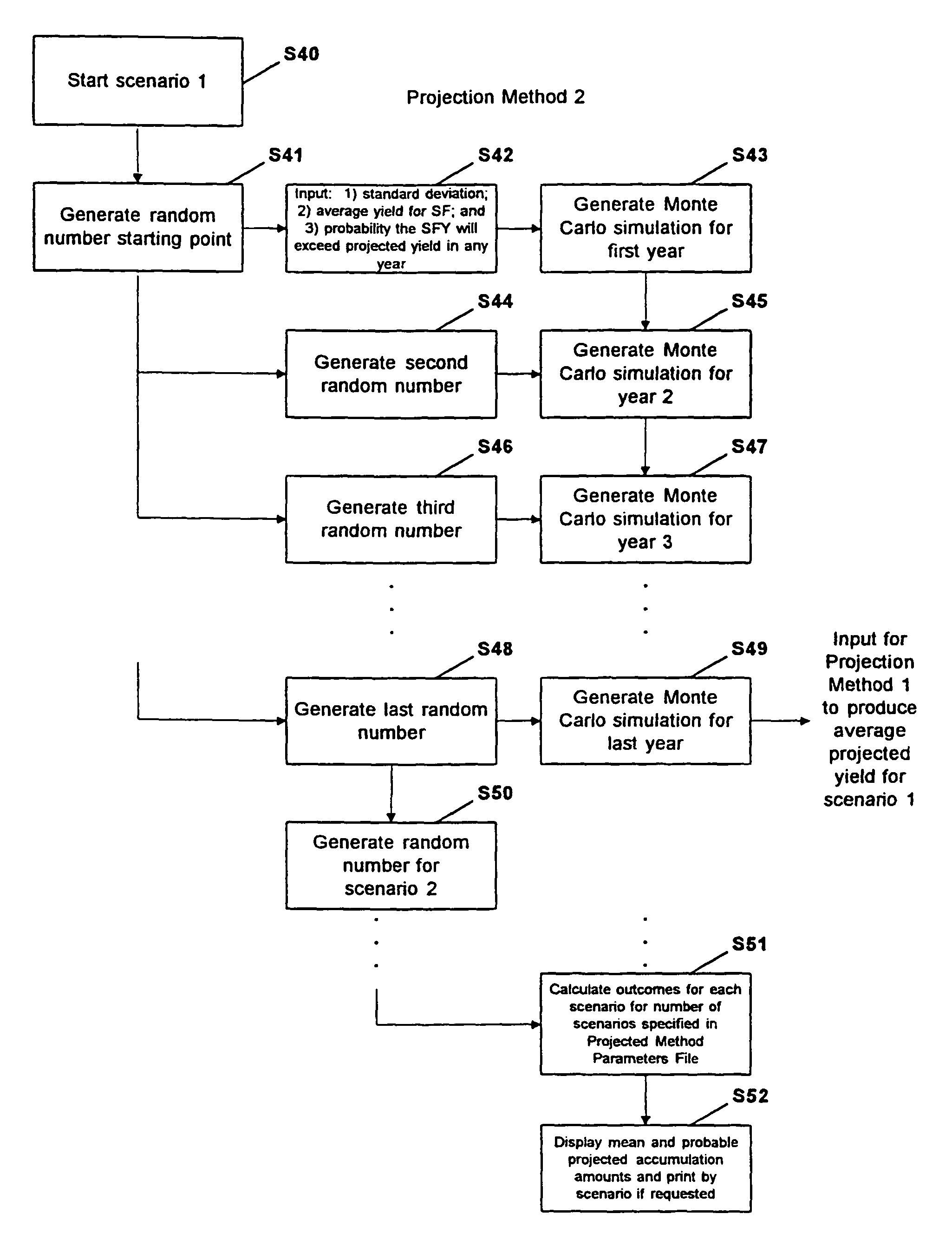

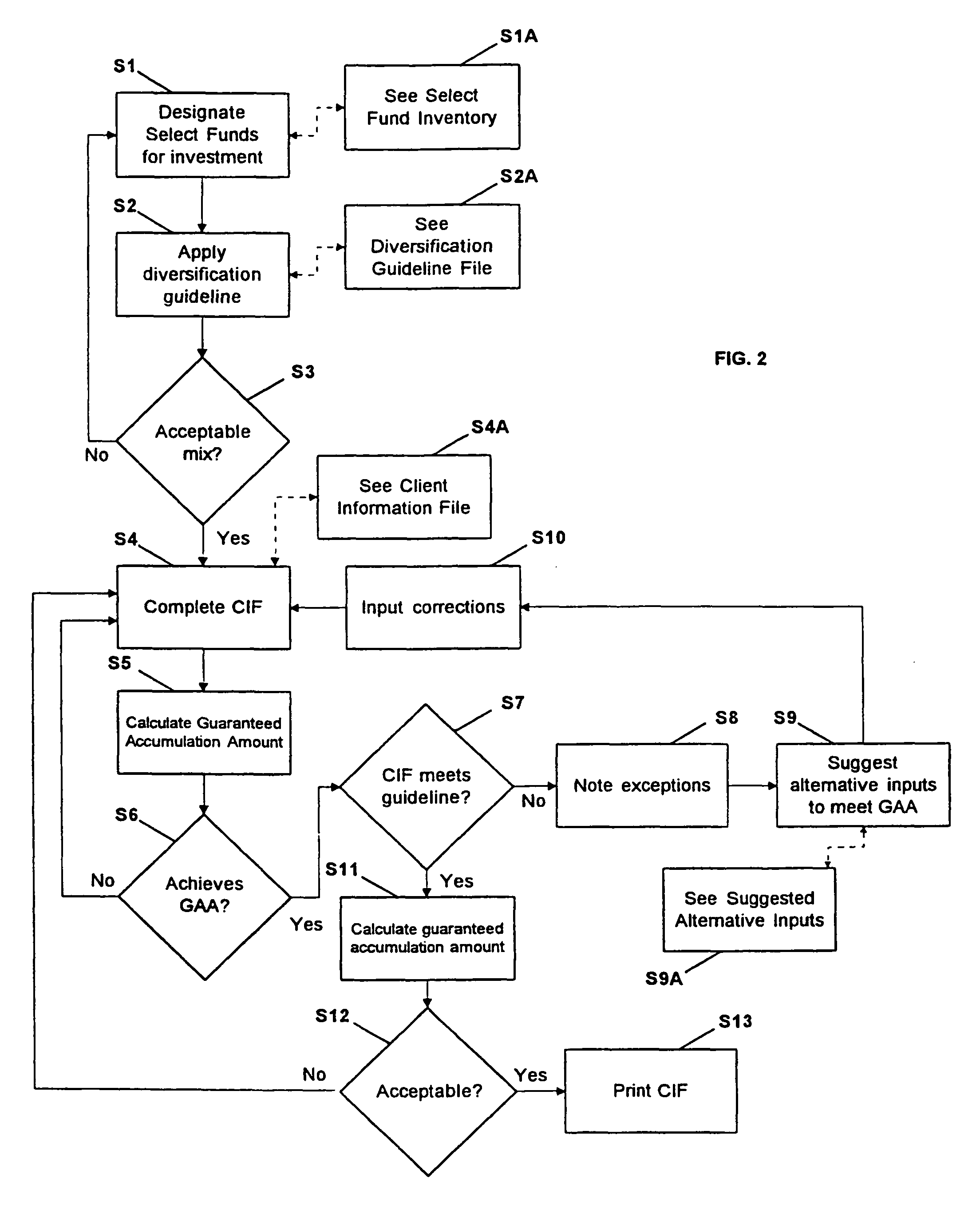

Method and system for establishing, monitoring, and reserving a guaranteed minimum value return on select investments

InactiveUS7778907B1Focused and enhanced consumer benefitMaximize the benefitsFinanceEngineeringAnnuity

The present invention provides a method and system for assuring a minimal guaranteed return on long-term investments, such as mutual funds or variable annuities. The invention includes a method and system for pricing, administration, customer presentation, and reserving relating to the guaranteed minimum return assurance. In addition, the present invention includes a method and system for allowing individual investors to control and easily change their typical asset allocation strategies. In order to accomplish the minimum guaranteed return, the present invention also includes sophisticated projection techniques, such as Monte Carlo simulation of investment performance. The present invention also includes features that allow the tracking of payments and removal of overcontributions from selected accounts, use of reserving techniques, optimizing investment diversification, proposal, issue, and administration of variable annuity riders, such as guaranteed minimum variable income benefit riders and guaranteed minimum income benefit riders, linkable to guaranteed minimum death benefits, and establish a charge for the guarantee.

Owner:CITICORP LIFE INSURANCE +1

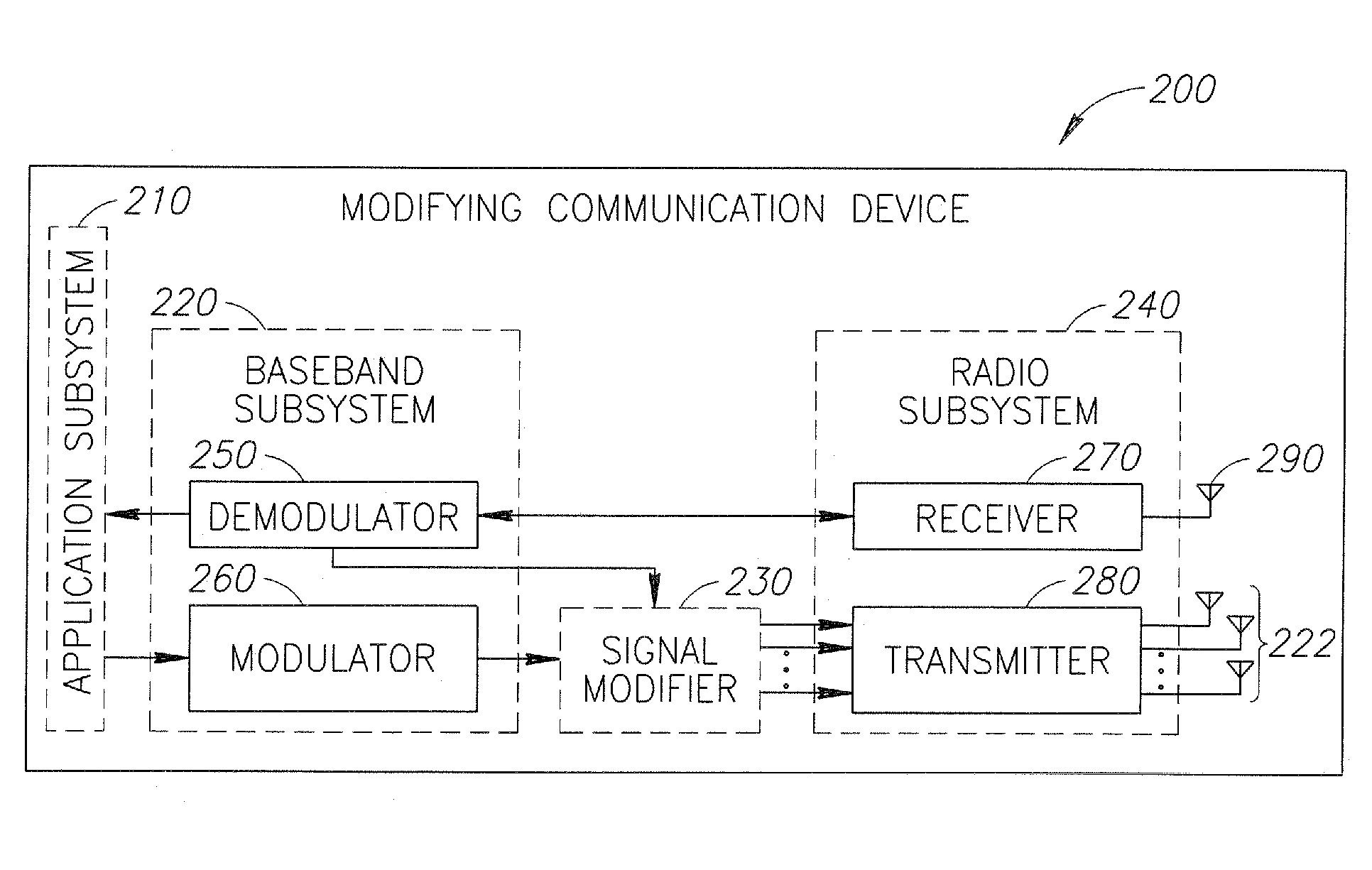

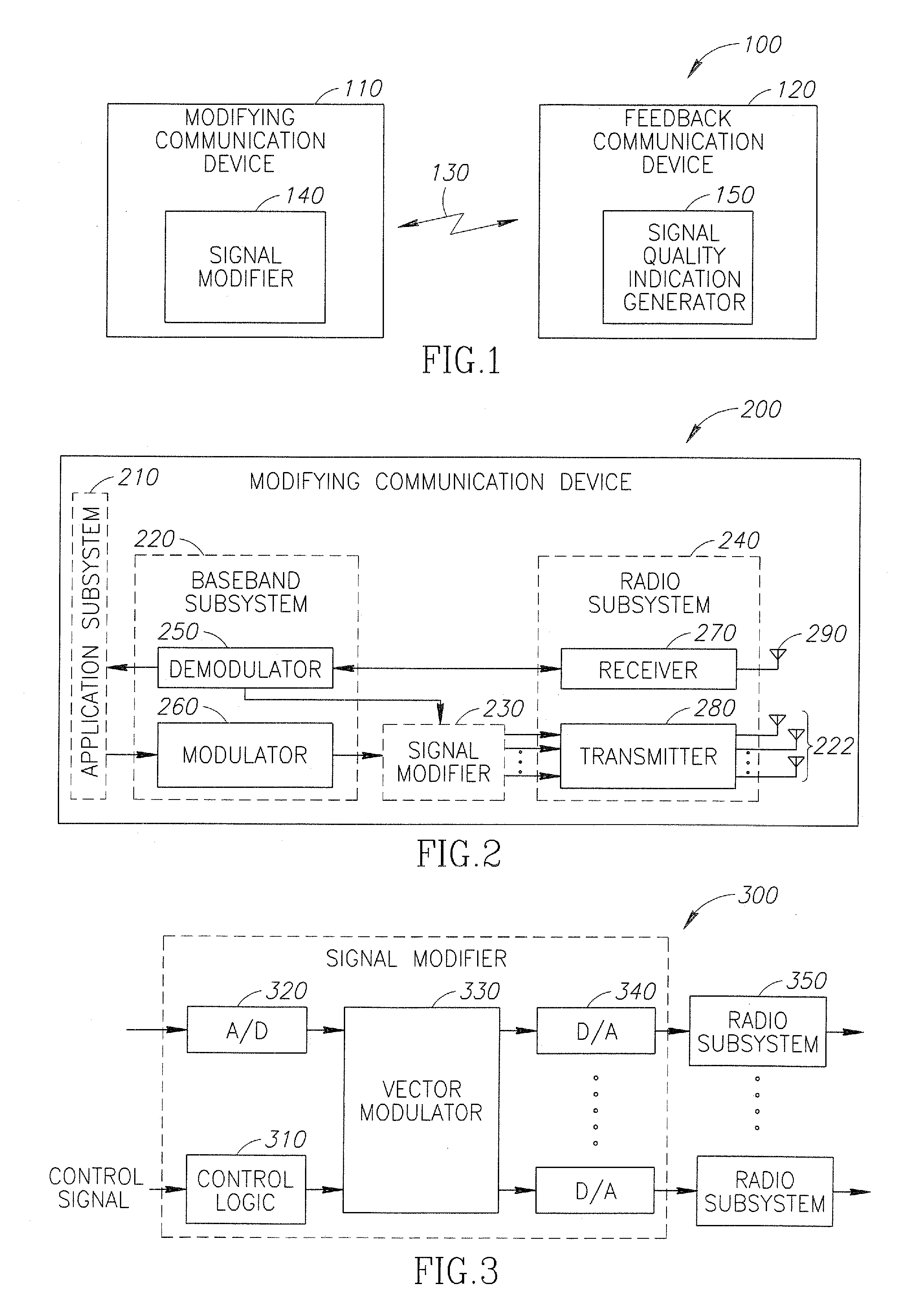

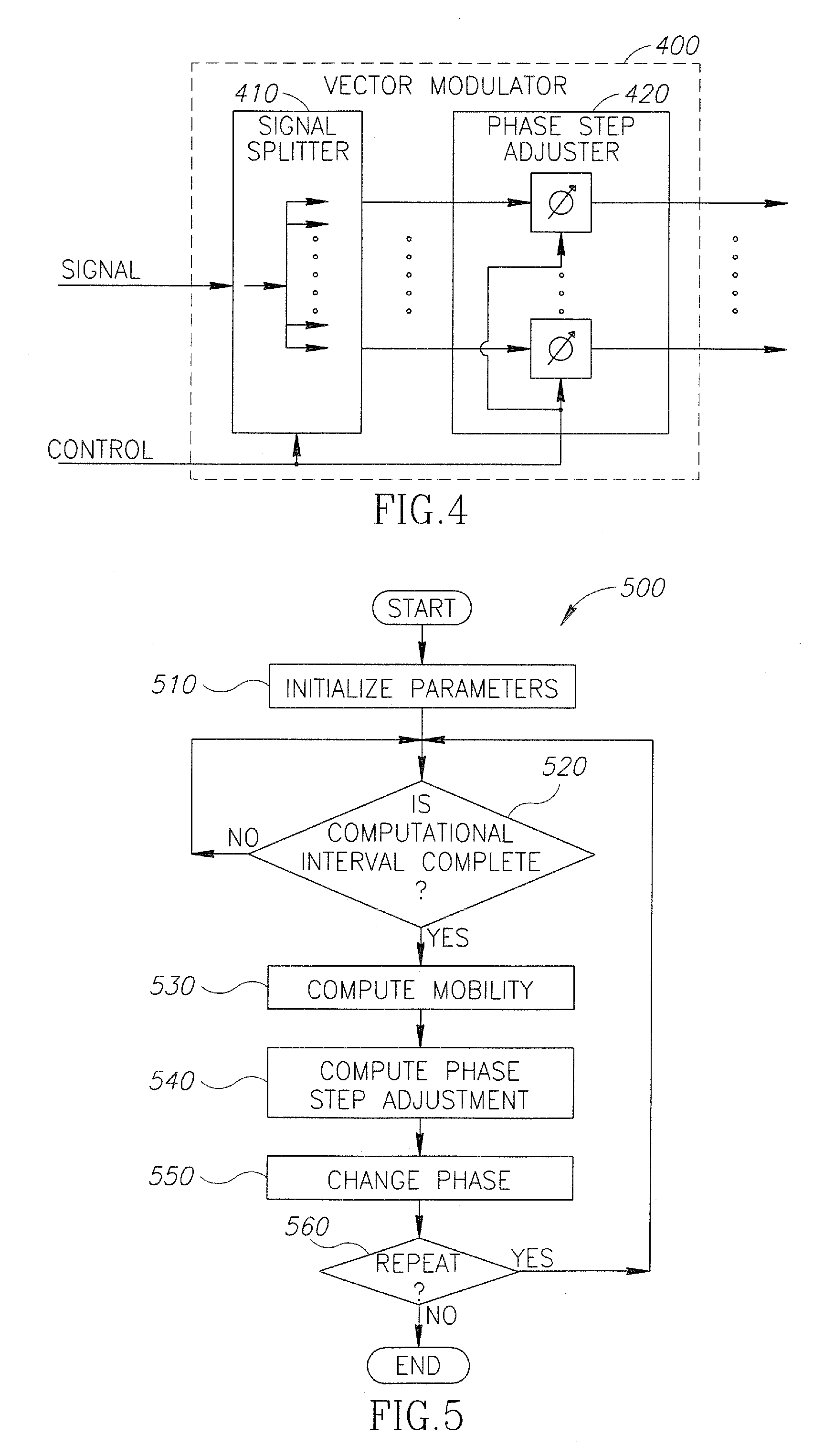

System, method and apparatus for transmit diversity control based on variations in propagation path

InactiveUS20080227414A1Maximize the benefitsQuick changeSite diversityElectromagnetic wave modulationNetwork conditionsPath condition

A method and apparatus for applications of identification of variations of propagation path to transmit diversity control. Transmit diversity parameters may be modified according to detected dynamics, which may, for example, be related to changes in actual propagation and network conditions. Such dynamics may be referred to as mobility parameters. Mobility parameters may apply to variability in a propagation path due to any conditions. Determination of a mobility parameter may be conducted using one or more of multiple parameters available to the mobile terminal. Such feedback information indication, which is related to the propagation path conditions, may be provided to the apparatus, which would attempt to find a more desired mode of operation, which may lead to reduction in power and the improvement of the quality of transmission.

Owner:GOOGLE LLC

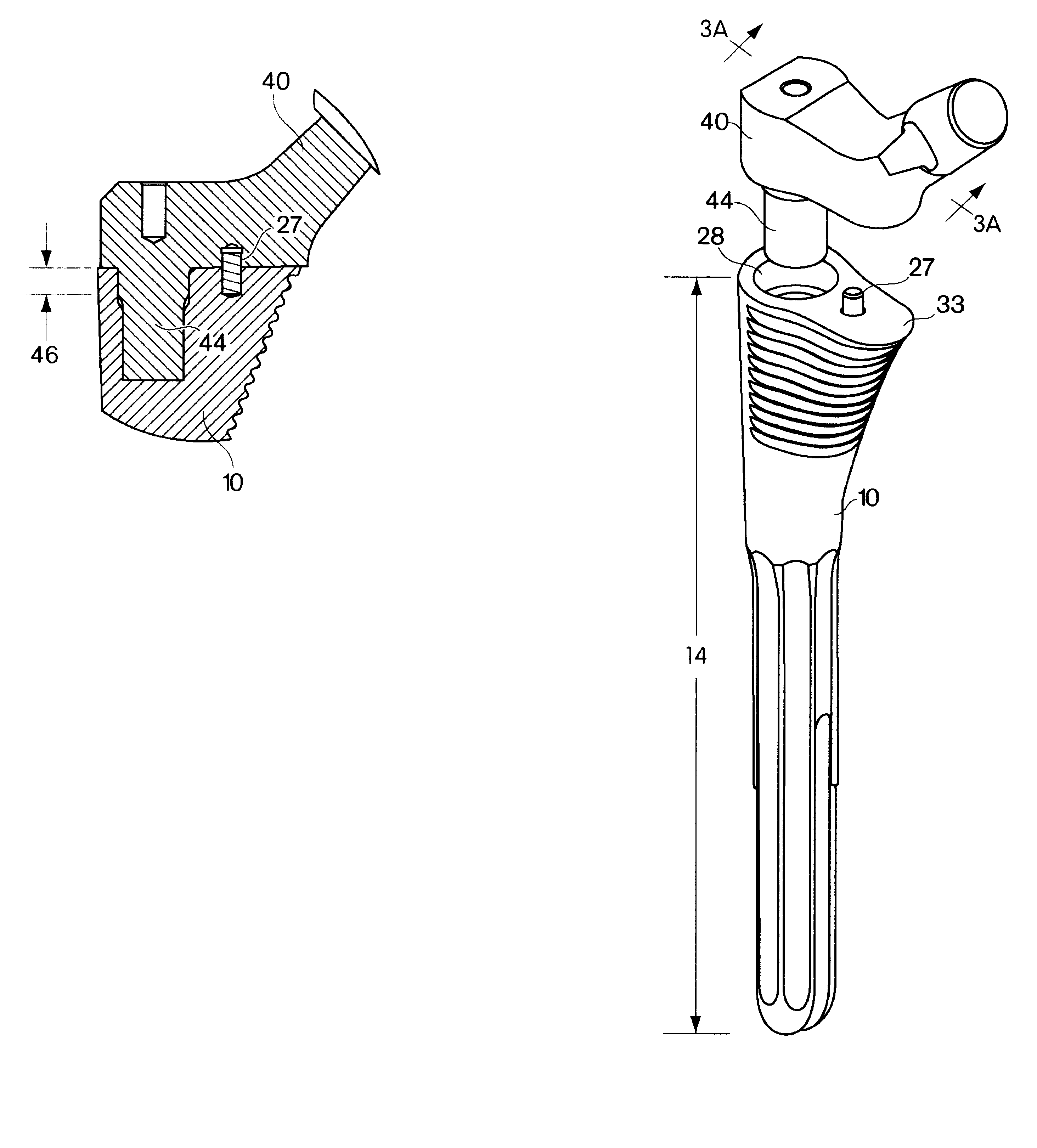

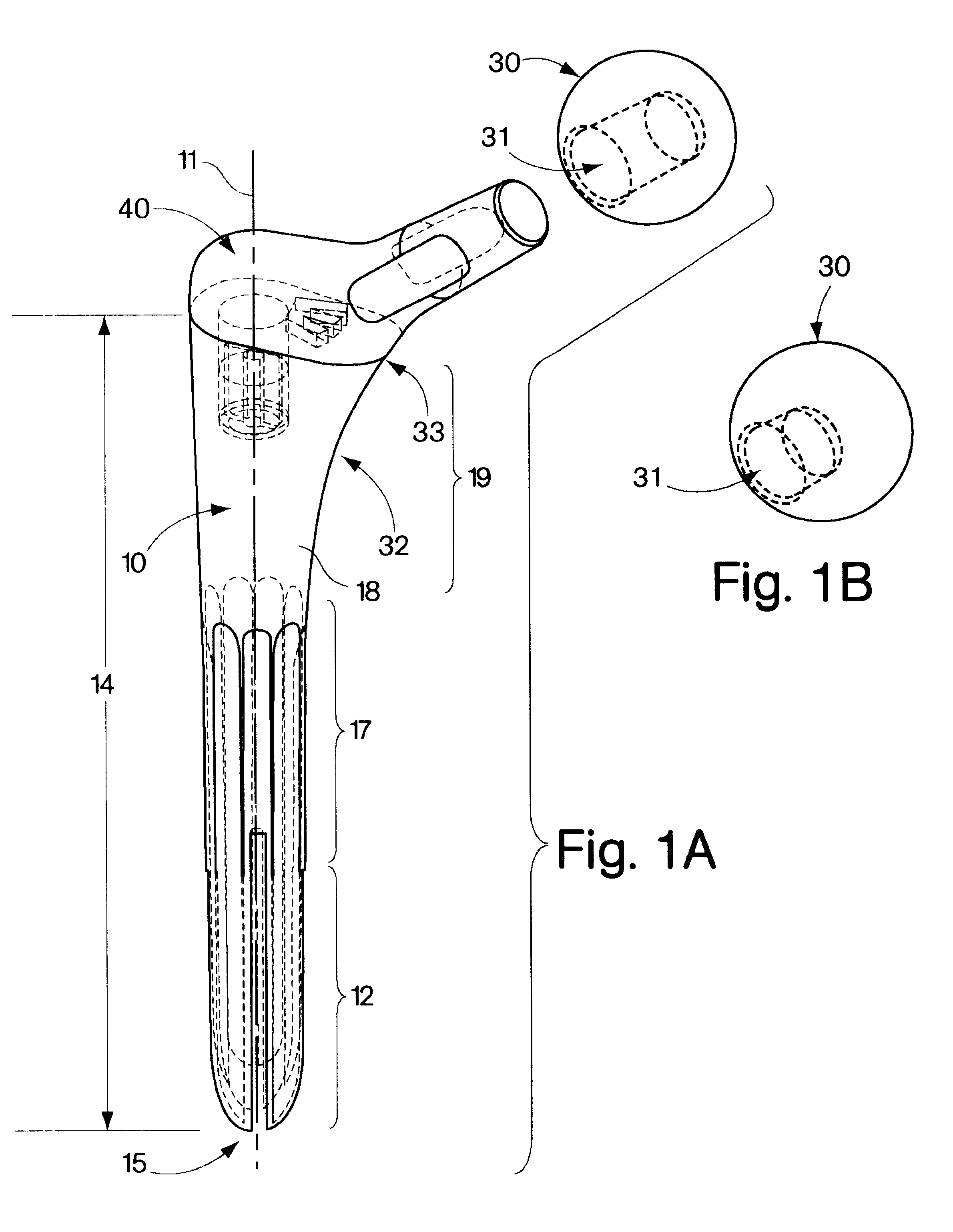

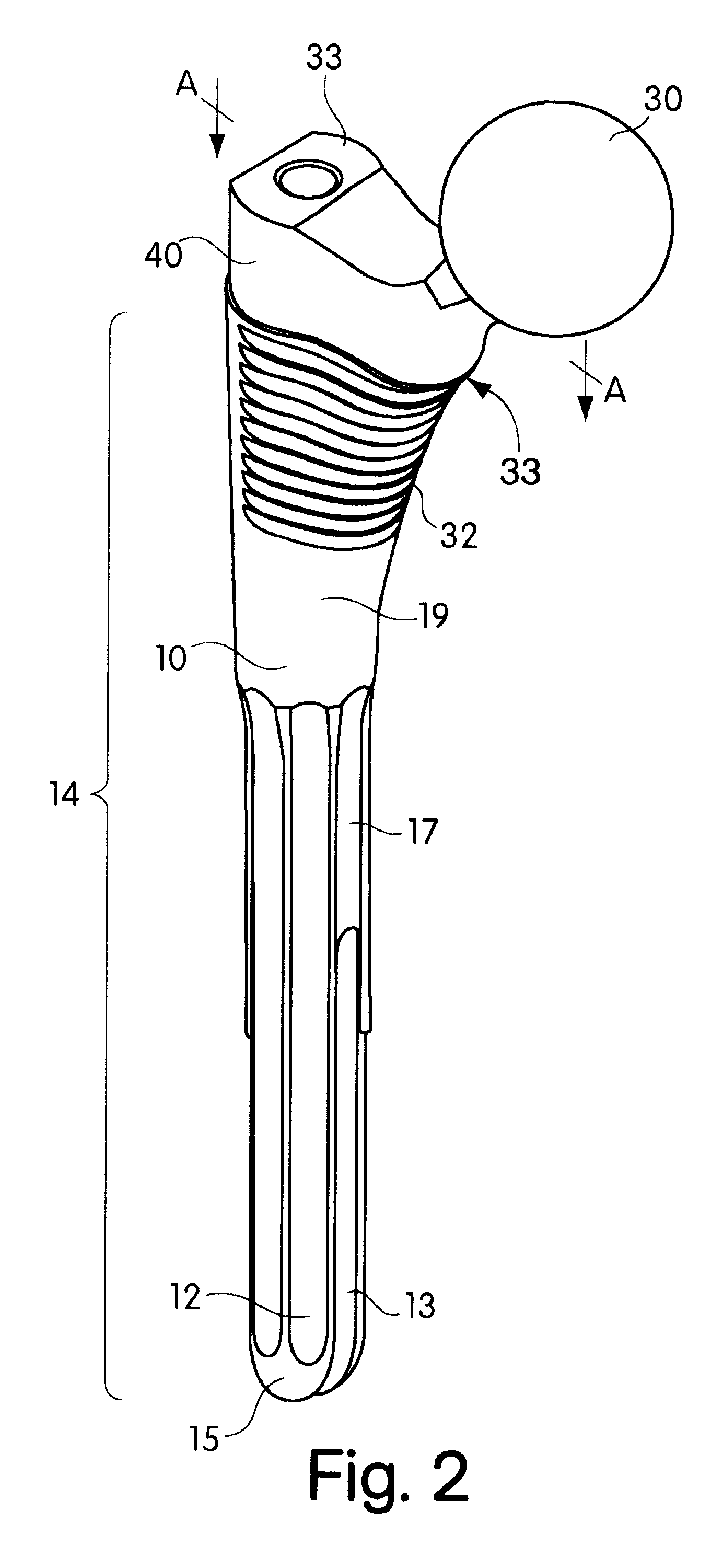

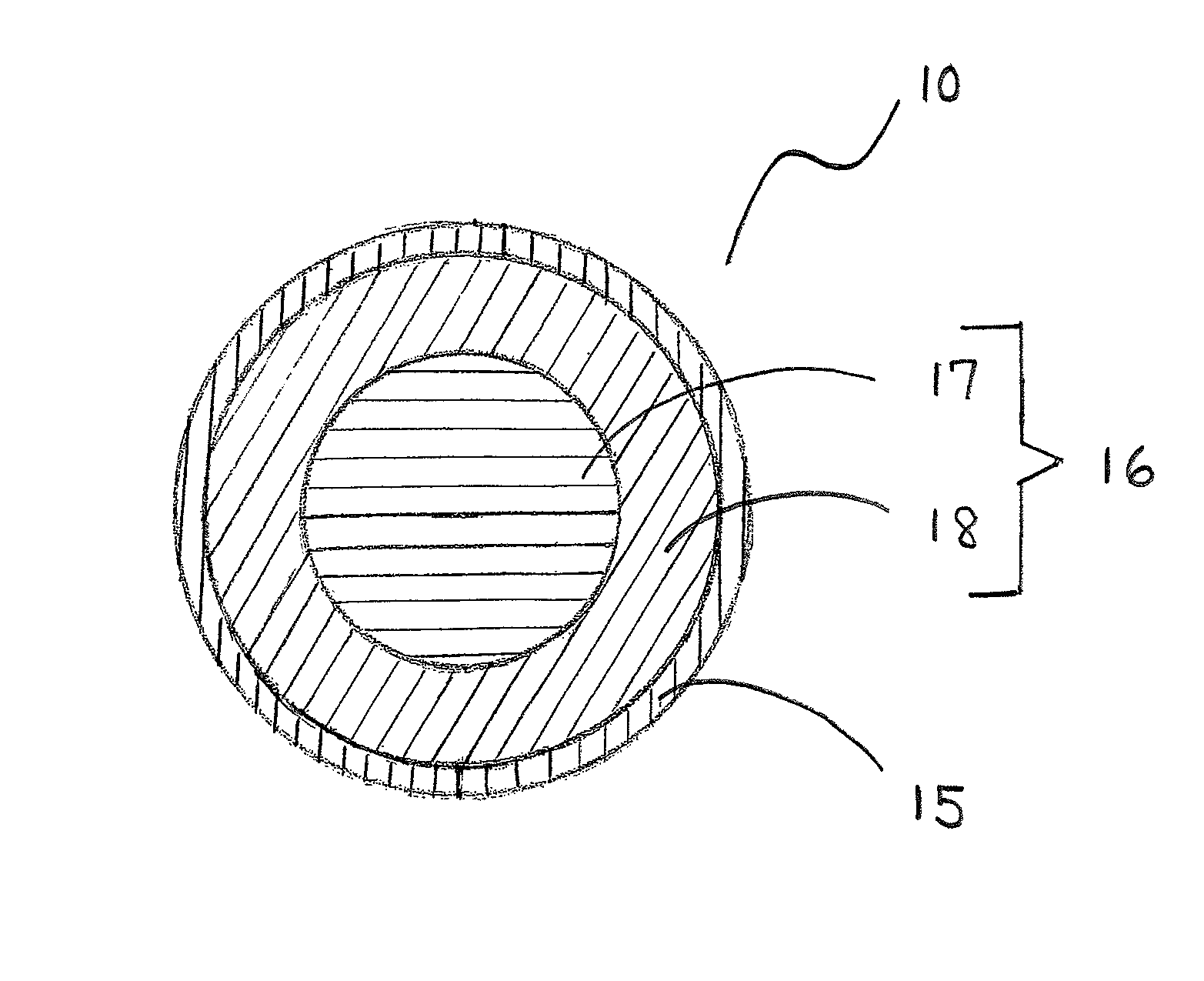

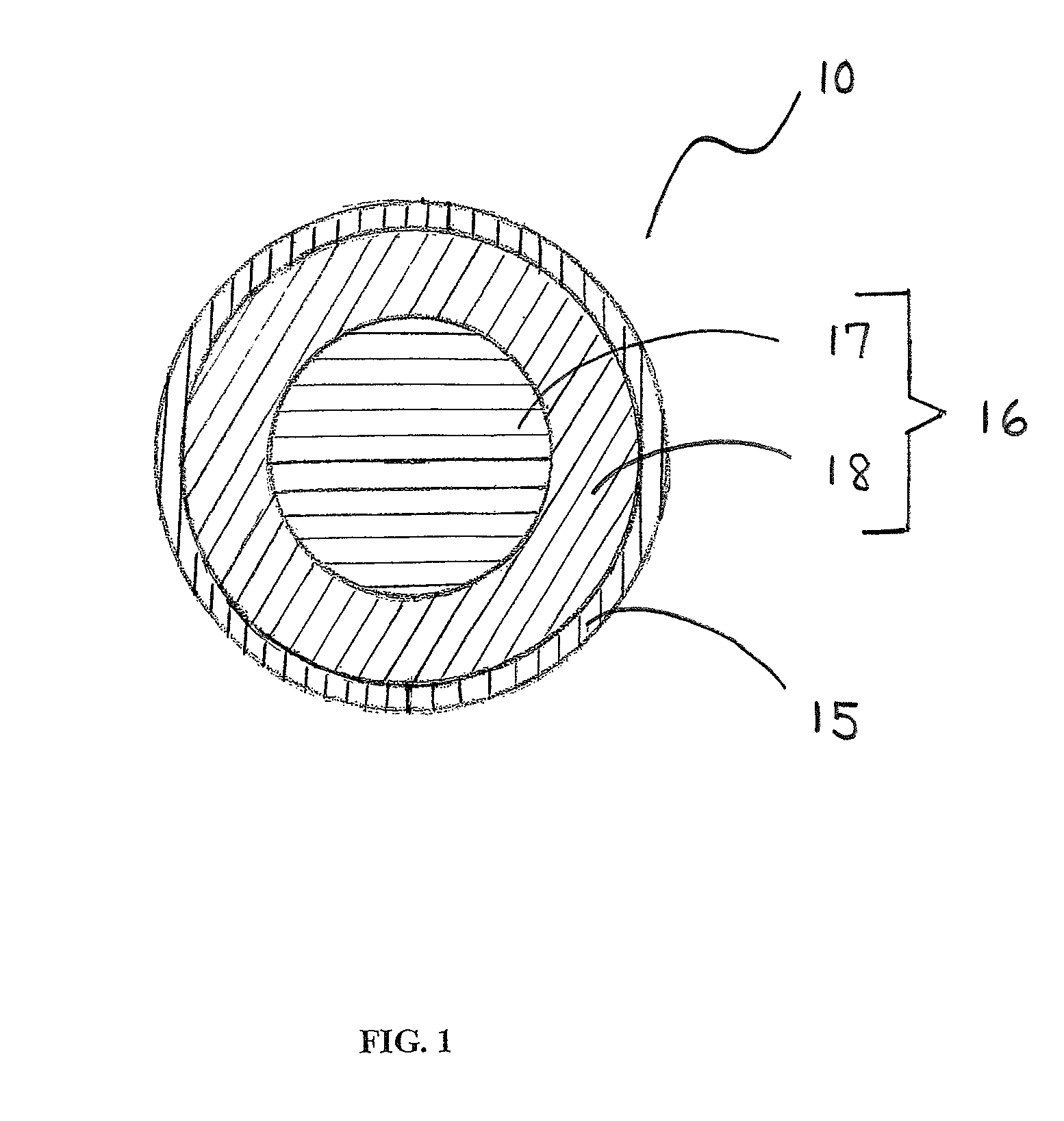

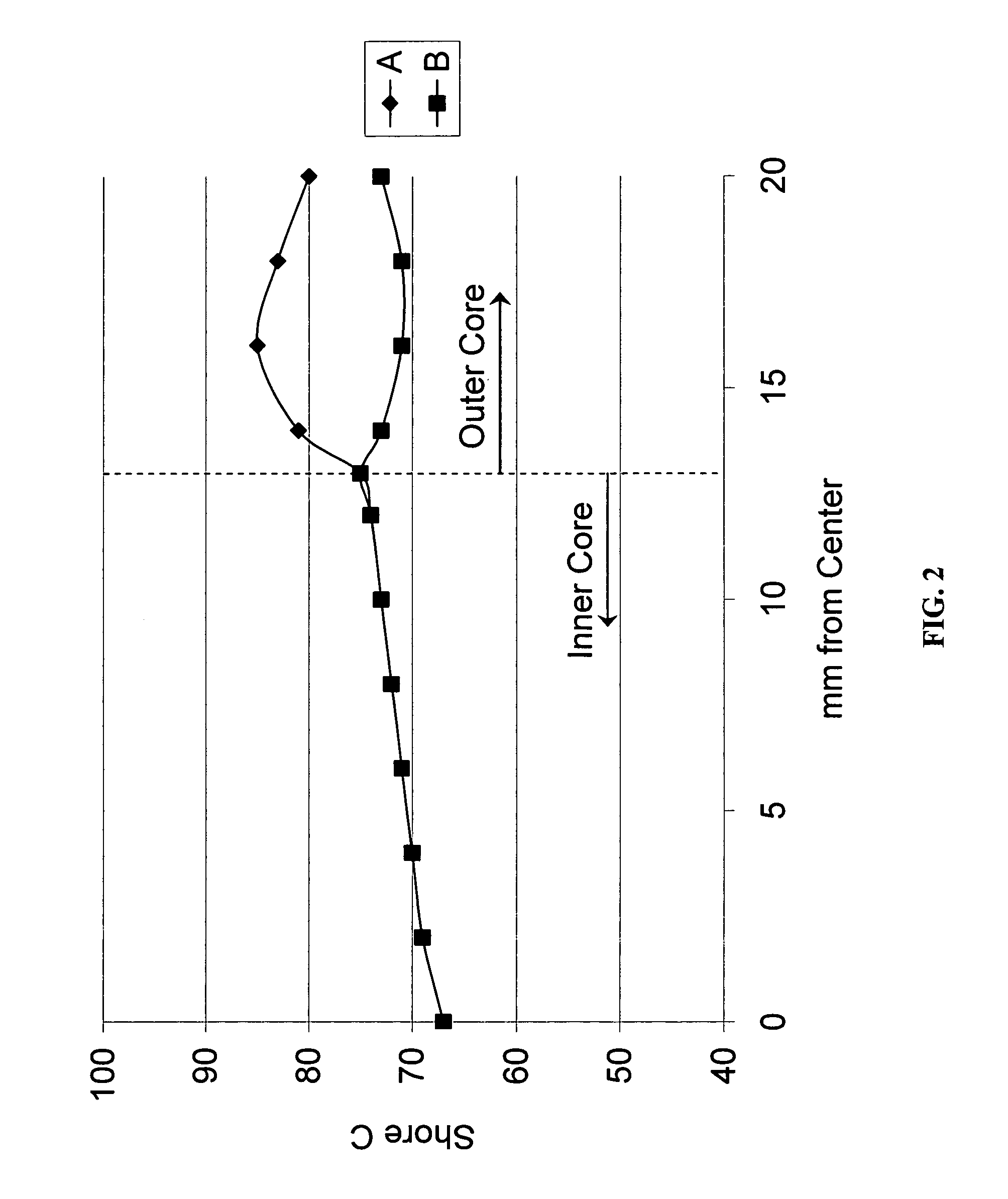

Joint prostheses and components thereof

InactiveUS7044975B2Maximize the benefitsIncrease or decrease lengthAnkle jointsJoint implantsSacroiliac jointBiomedical engineering

Modular joint prostheses and components thereof are disclosed. In an embodiment, a joint prosthesis may include a head member, a neck member, and a stem member.

Owner:OMNILIFE SCI INC

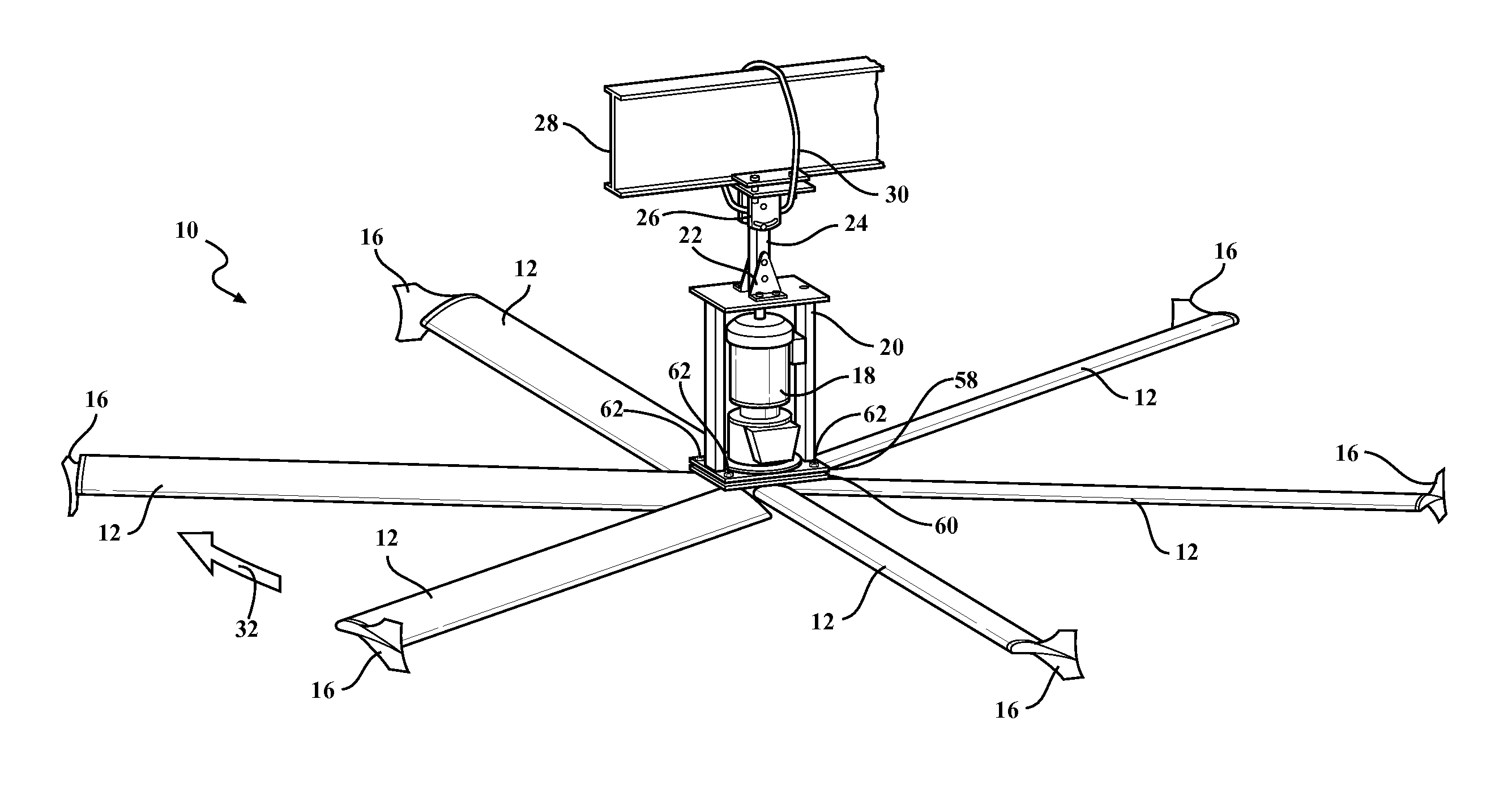

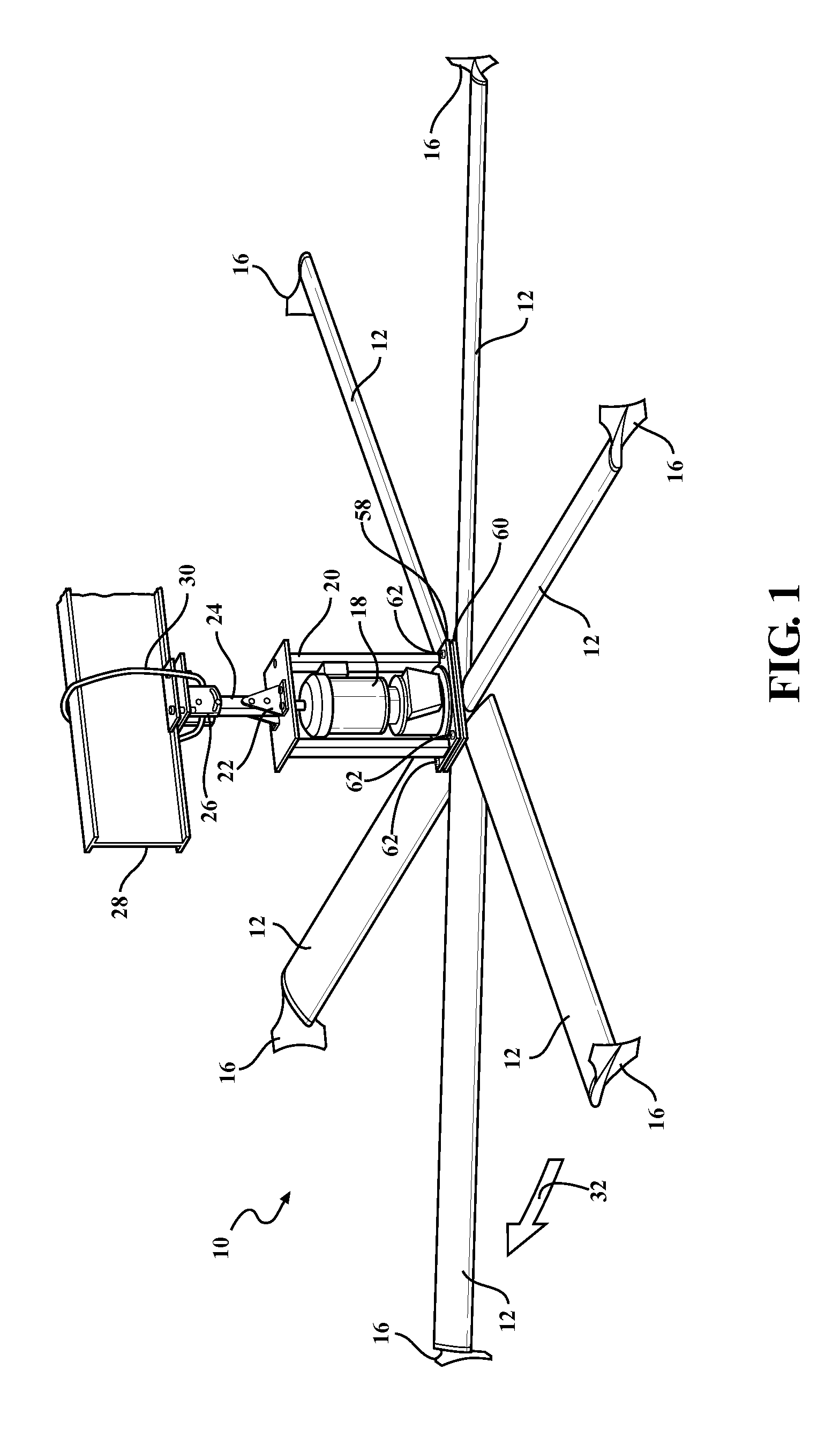

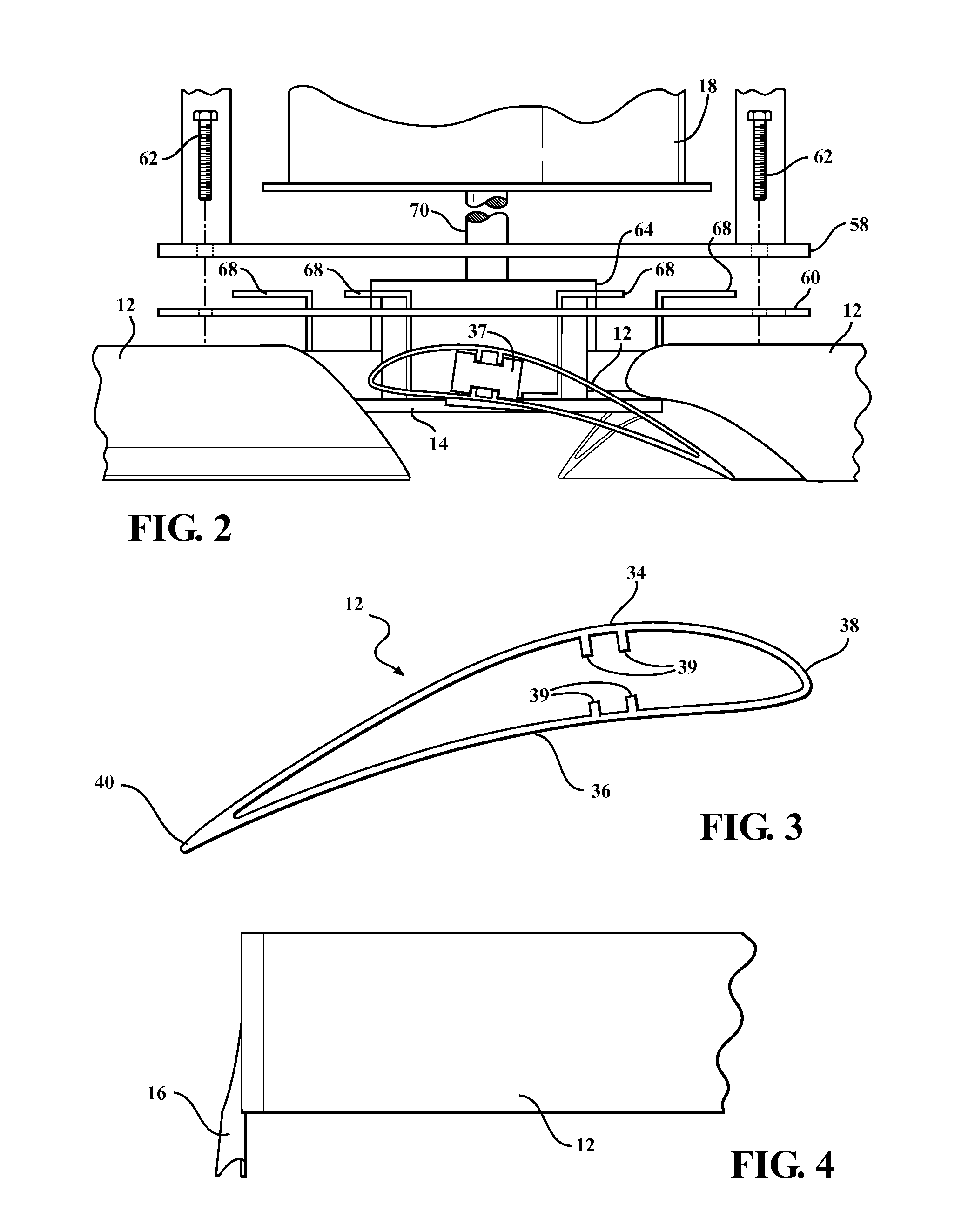

High volume low speed fan

An HVLS fan system uses STOL technology for airfoils and angle of attack thus optimizing air movement efficiency and reducing drag. The HVLS fan system includes wingtip fence end caps to the airfoils for improving efficiency by reducing drag. The HVLS fan system also includes an interconnection of the airfoils to a securing plate thus providing a failsafe and reduced potential for damage or injury resulting from failure of the connection between the airfoil array and a drive unit such as an electric motor and associated gearing.

Owner:SKYBLADE FAN

Methods and systems for recommending an appropriate action to a patient for managing epilepsy and other neurological disorders

ActiveUS8868172B2Reduction tendencyEasy to manageElectroencephalographyPhysical therapies and activitiesNeurological disorderEpileptic seizure

Owner:CYBERONICS INC

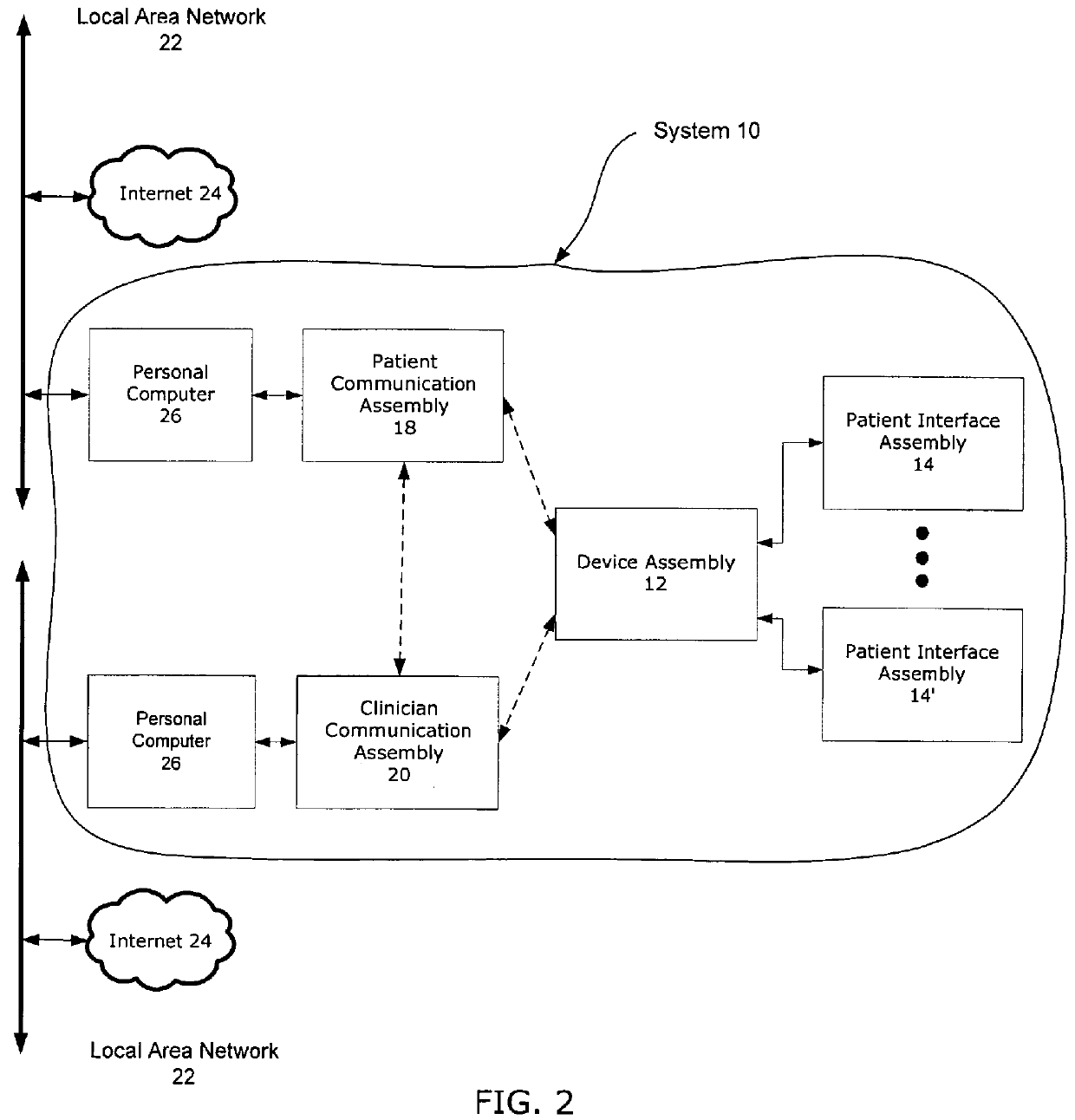

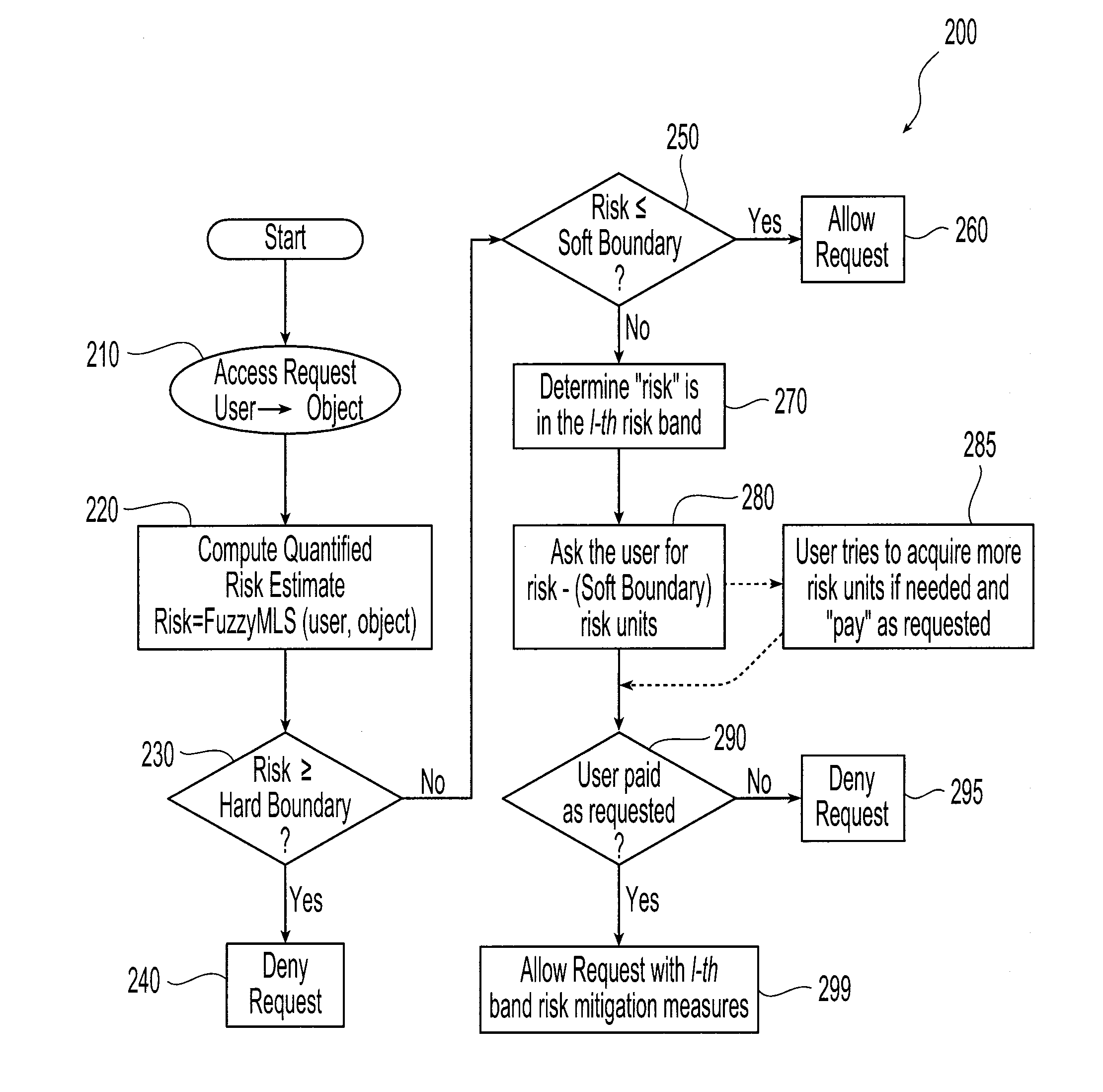

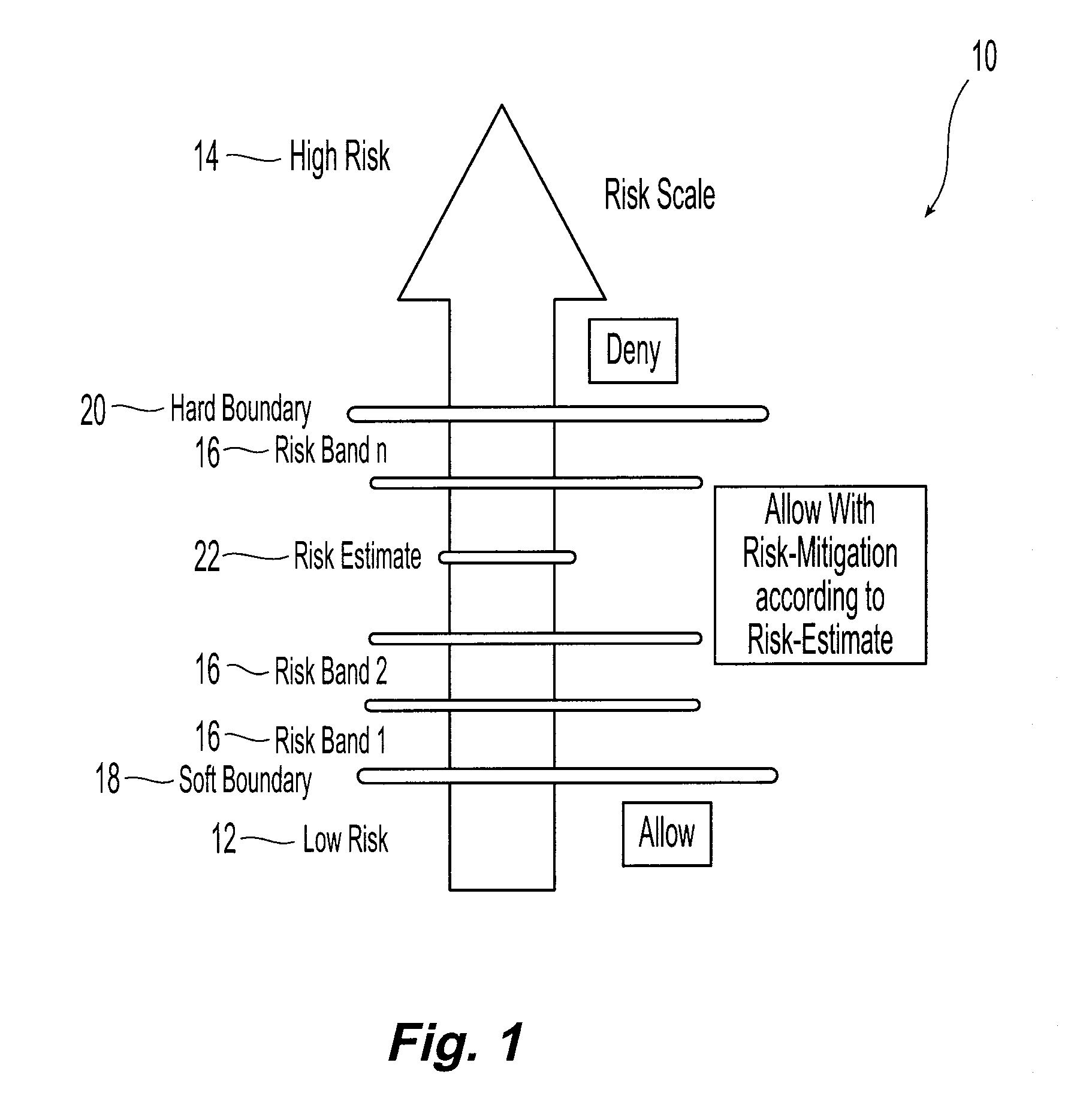

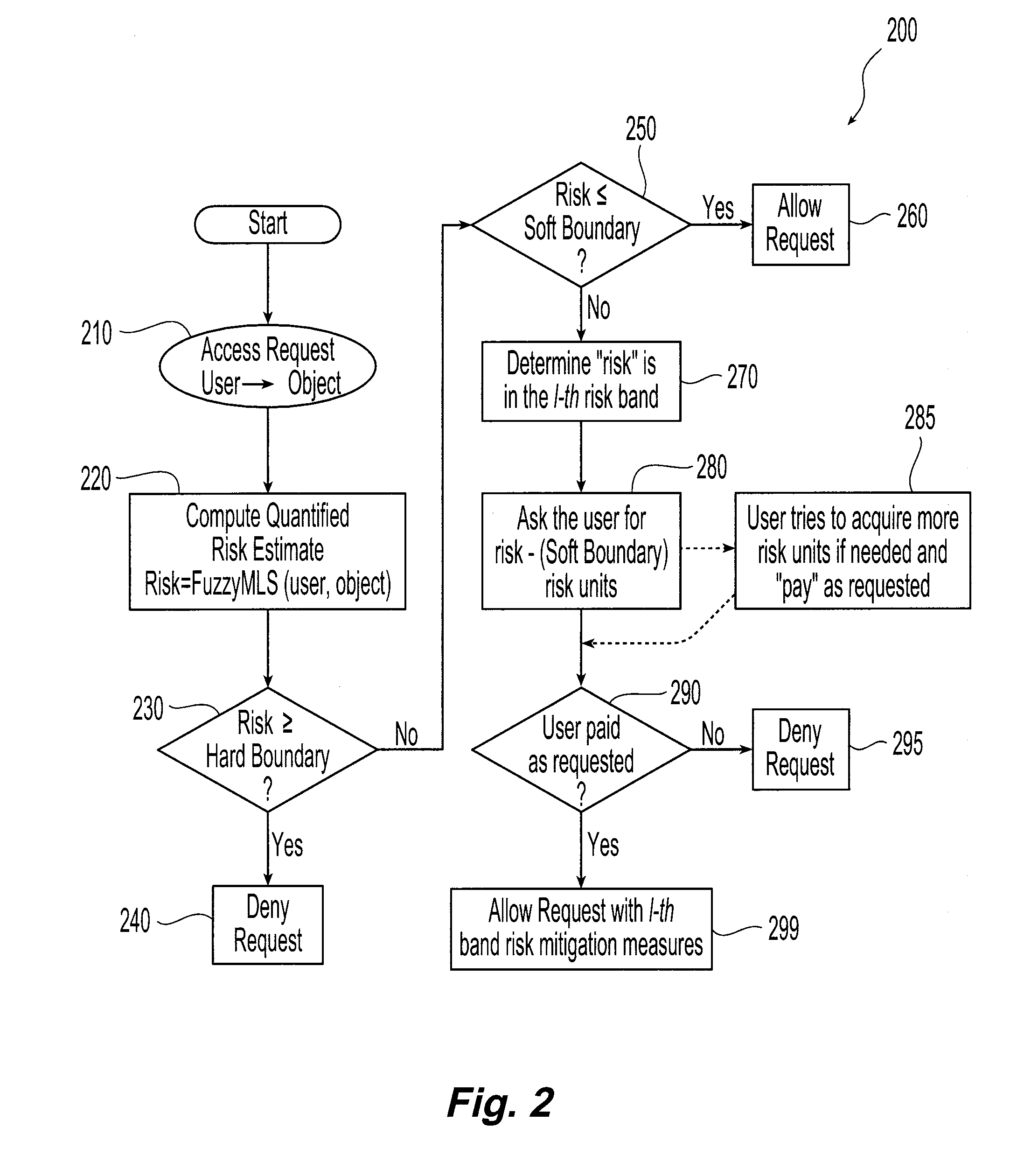

Risk Adaptive Information Flow Based Access Control

InactiveUS20110173084A1Benefit maximizationSuffer damageDigital data processing detailsAnalogue secracy/subscription systemsRisk quantificationKnowledge management

Systems and methods are provided to manage risk associated with access to information within a given organization. The overall risk tolerance for the organization is determined and allocated among a plurality of subjects within the organization. Allocation is accomplished using either a centralized, request / response or free market mechanism. As requested from subjects within the organization for access to objects, i.e. information and data, are received, the amount of risk or risk level associated with each requested is quantified. Risk quantification can be accomplished using, for example, fuzzy multi-level security. The quantified risk associated with the access request in combination with the identity of the object and the identity of the subject are used to determine whether or not the request should be granted, denied or granted with appropriated mitigation measures.

Owner:IBM CORP

Multi-tier benefit optimization for operating the power systems including renewable and traditional generation, energy storage, and controllable loads

ActiveUS7315769B2Maximize the benefitsMechanical power/torque controlSampled-variable control systemsElectric power systemPower grid

A plurality of power generating assets are connected to a power grid. The grid may, if desired, be a local grid or a utility grid. The power grid is connected to a plurality of loads. The loads may, if desired, be controllable and non-controllable. Distribution of the power to the loads is via a controller that has a program stored therein that optimizes the controllable loads and the power generating assets. The optimization process is via multi-tier benefit construct.

Owner:GENERAL ELECTRIC CO

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com