Patents

Literature

248 results about "Annuity" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

An annuity is a series of payments made at equal intervals. Examples of annuities are regular deposits to a savings account, monthly home mortgage payments, monthly insurance payments and pension payments. Annuities can be classified by the frequency of payment dates. The payments (deposits) may be made weekly, monthly, quarterly, yearly, or at any other regular interval of time.

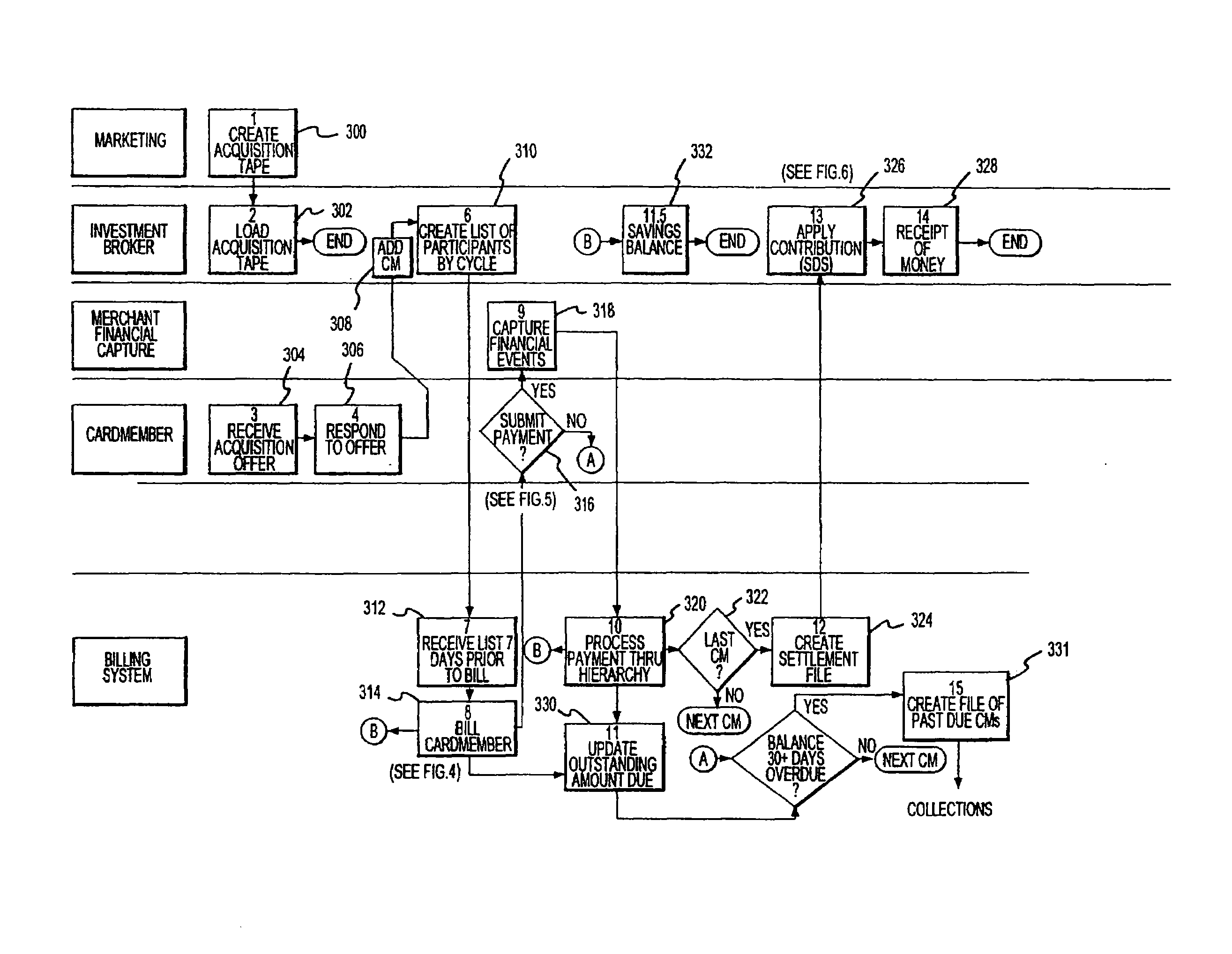

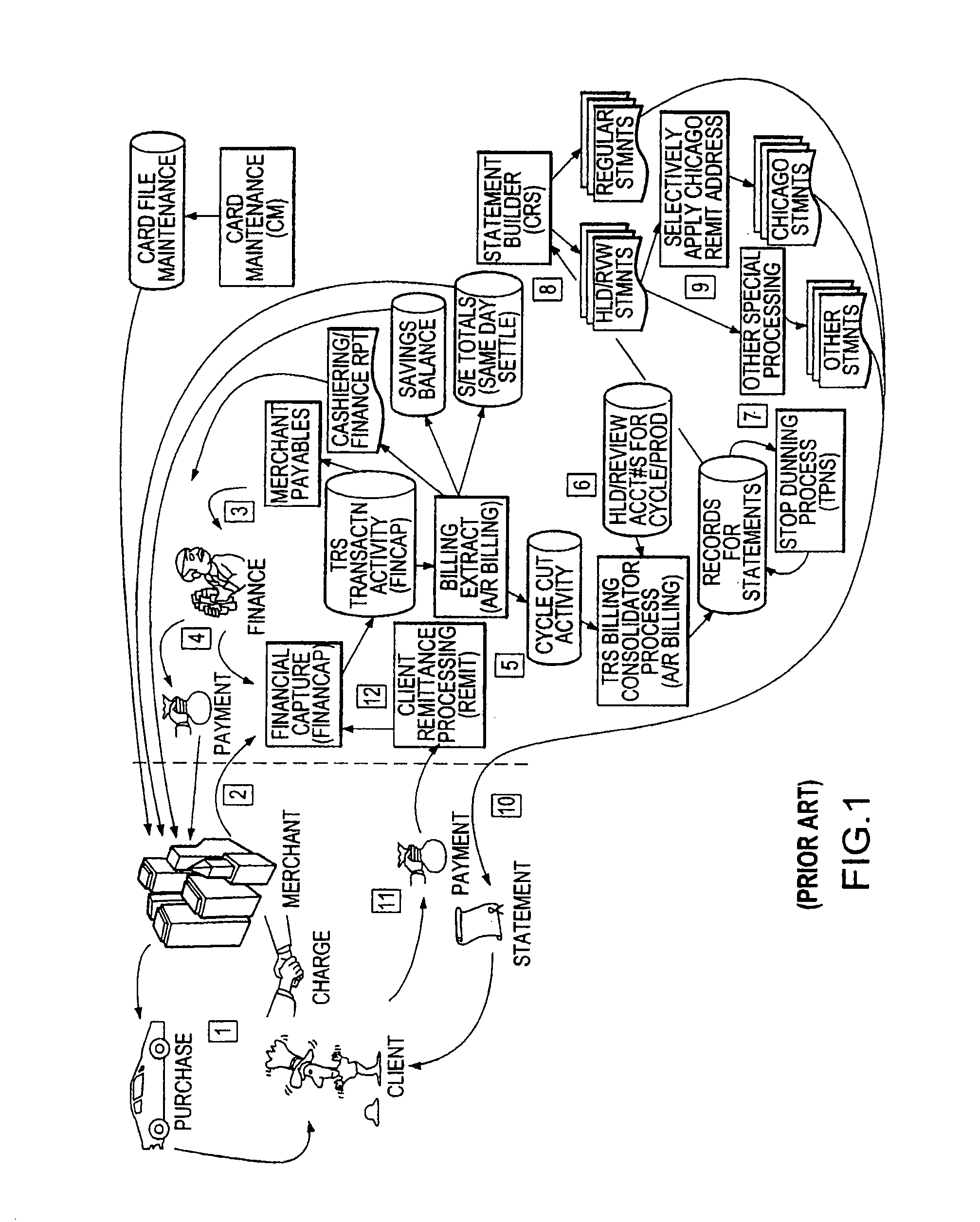

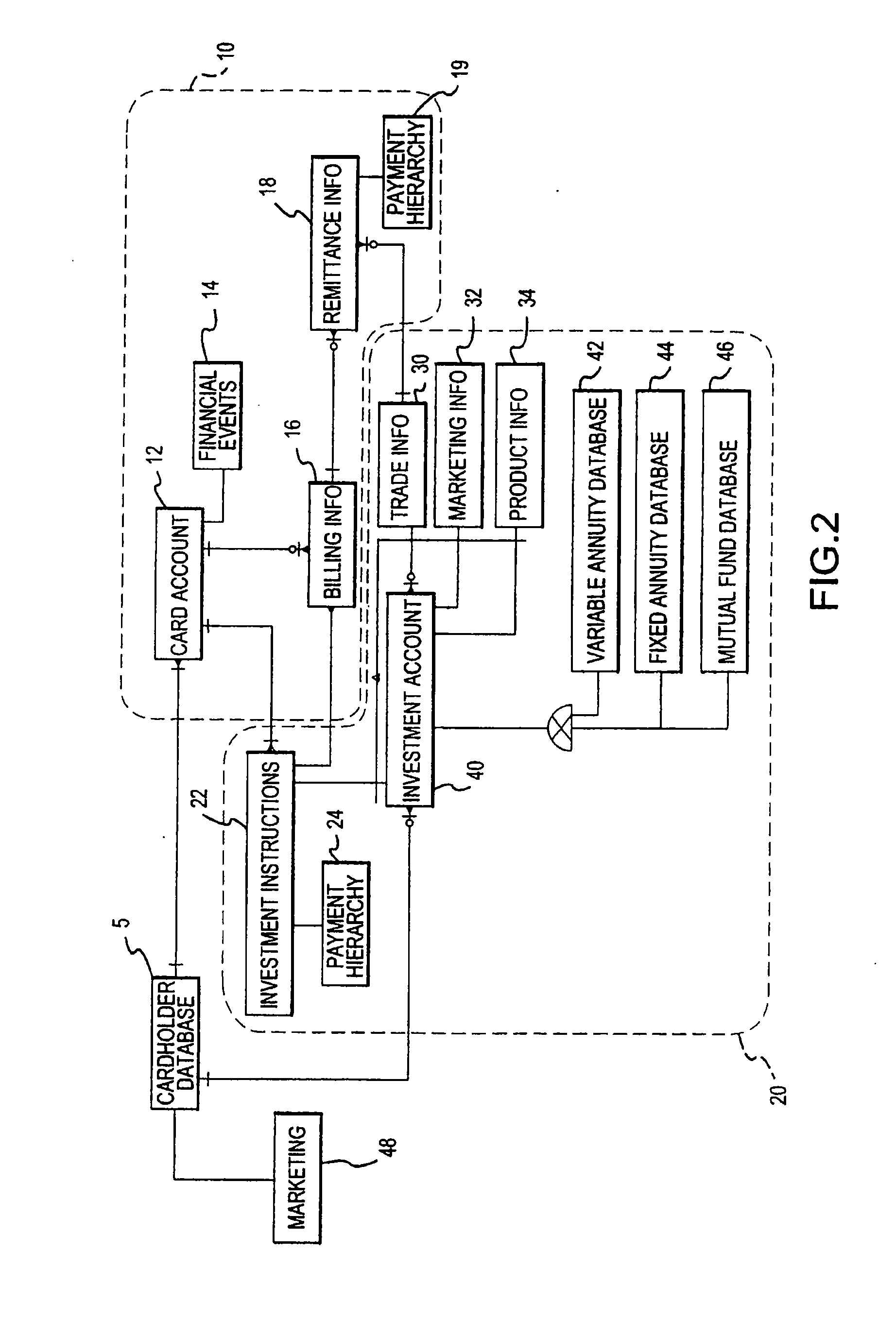

System and method for dividing a remittance and distributing a portion of the funds to multiple investment products

A known charge card billing system communicates with an investment broker system, wherein the investment broker system includes an instruction arrangement database, payment hierarchy and an investment account. An interested cardholder suitably appoints the charge card administrator as a processing agent to collect and promptly remit the cardholder's voluntary, periodic payments for investment into preselected investment products, such as, for example, mutual fund shares, fixed annuities, variable annuities, CDs, insurance, certificates, equities and / or the like. The billing system distributes a billing statement at the end of each month, wherein the statement includes all of the charges for that month and a reminder to remit an additional dollar amount for the preselected investments. The cardholder then sends a single payment for the charges and the investments to the charge card administrator. After receiving the payment, the system appropriately unbundles the payment and distributes the remitted payment to the card account to satisfy the captured financial events and to the investment broker system for the purchase of investment products.

Owner:AMERIPRISE FINANCIAL

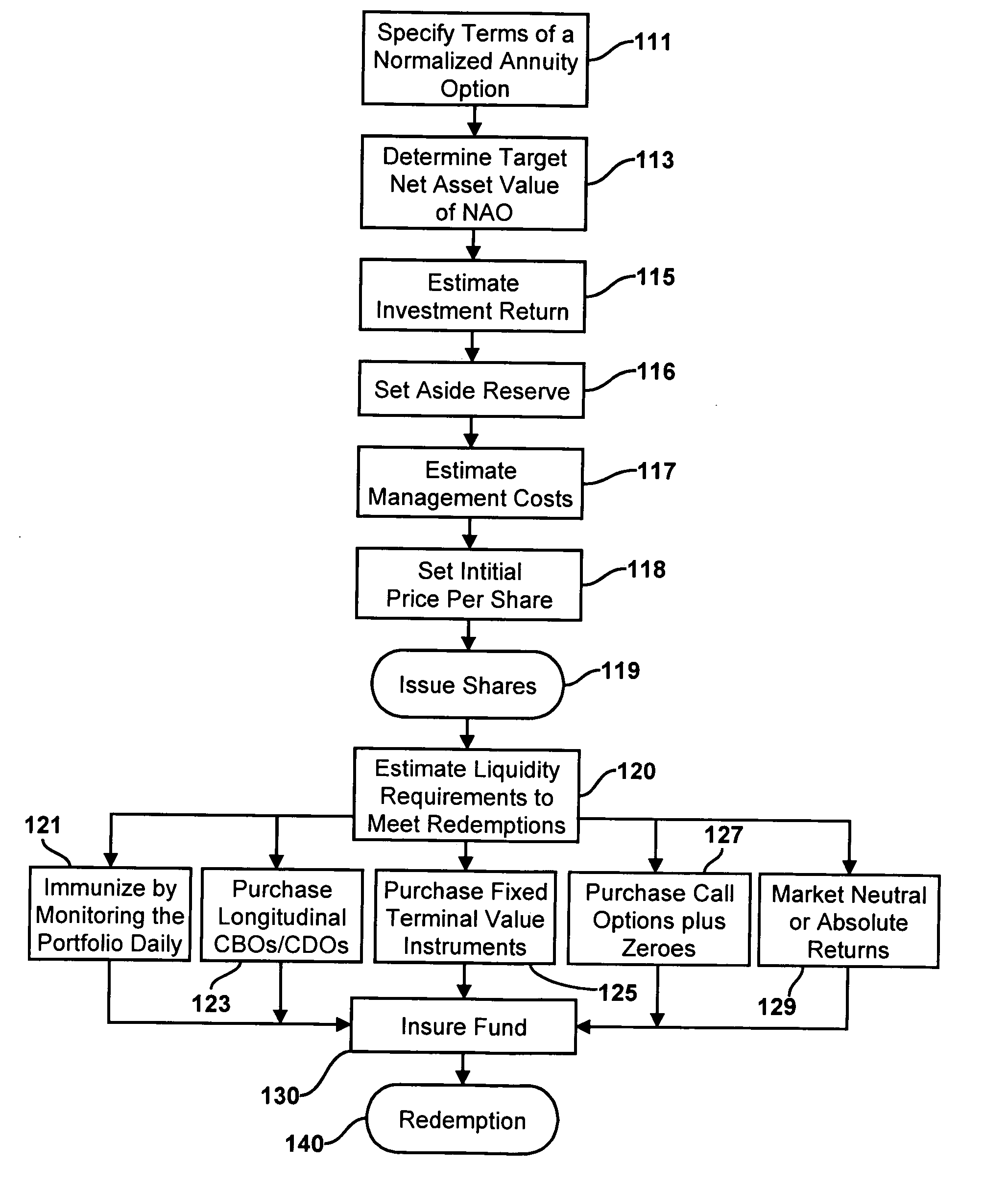

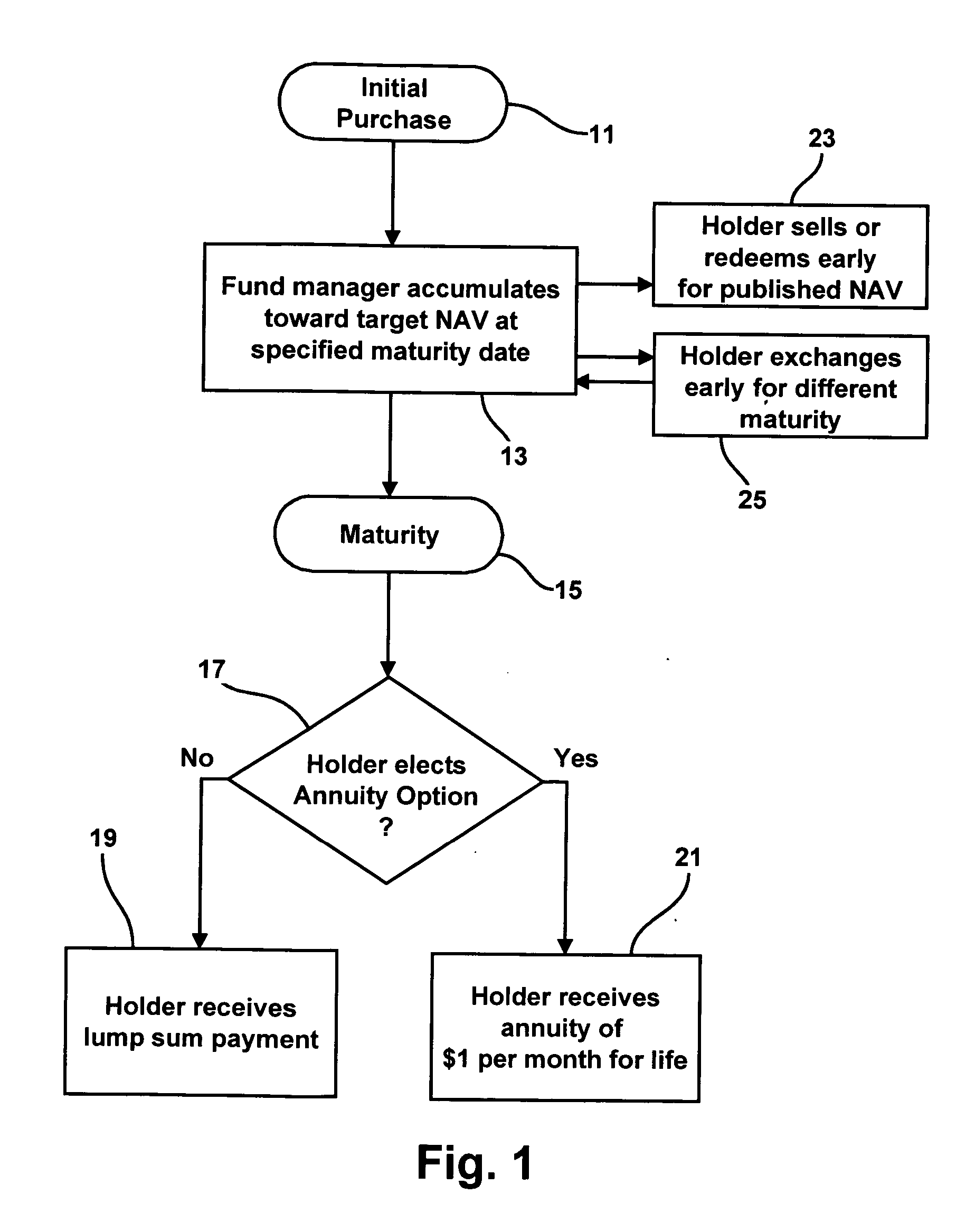

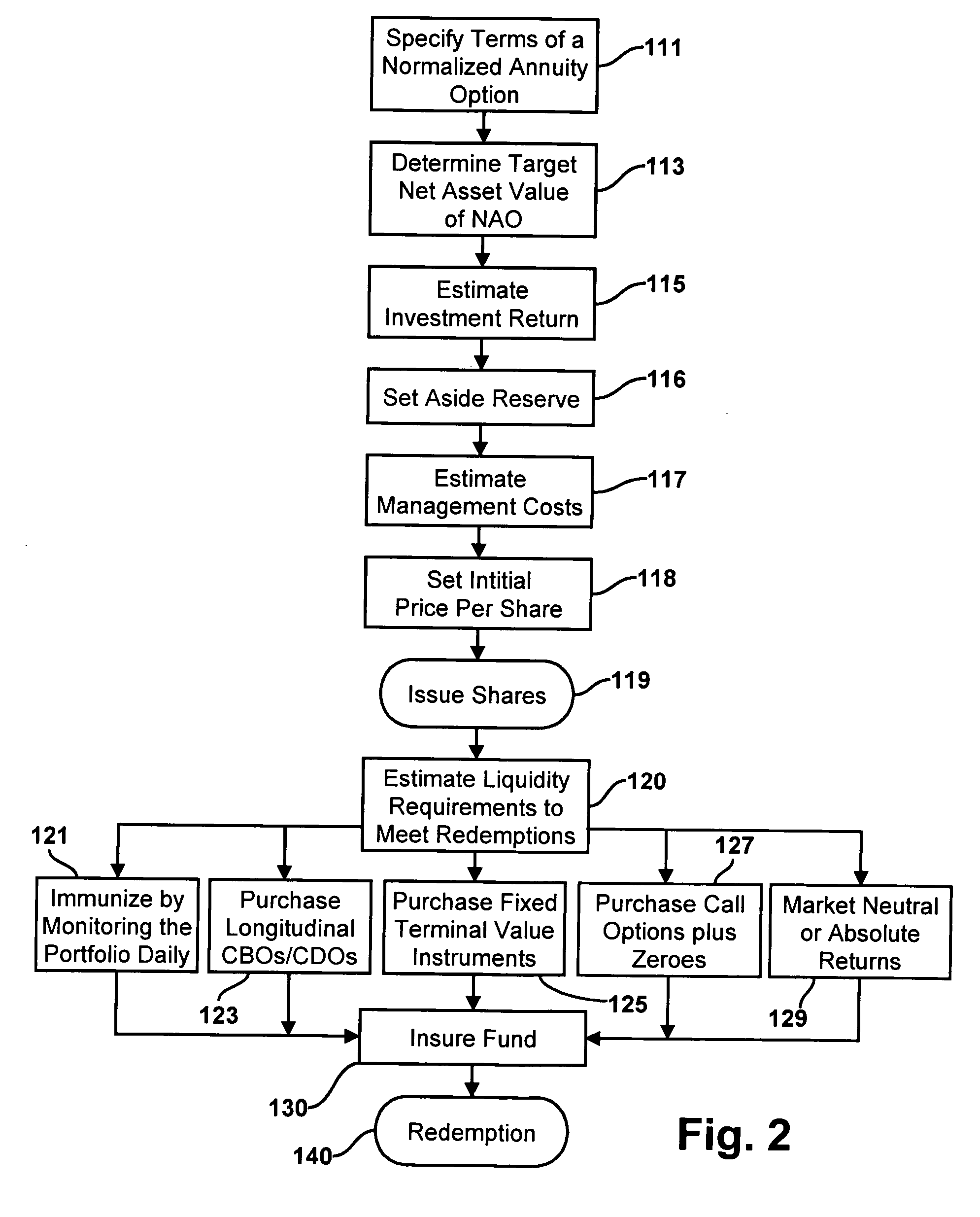

Methods for issuing, distributing, managing and redeeming investment instruments providing normalized annuity options

A method of issuing and managing investment instruments called “Pension Shares” which preferably take the form of securities that represents a claim against and is secured by an investment fund. A Pension Share entitles its holder to receive, at a specified maturity date, either a lump sum payment amount or, at the option of said holder, to receive a sequence of annuity payments. The Pension Share issuer creates and manages the investment fund such that its net asset value at the maturity date will be adequate to make the lump sum payment or provide the holder with the annuity. A preferred form of Pension Share provides an annuity option of one dollar per for the life of the holder, or his or her survivor, both of whom are at a predetermined age at the maturity date. A Pension Share may be redeemed on demand in advance of the maturity date so that it may be exchanged for a Pension Share having a different maturity date if the holder's plans change.

Owner:RETIREMENT ENG

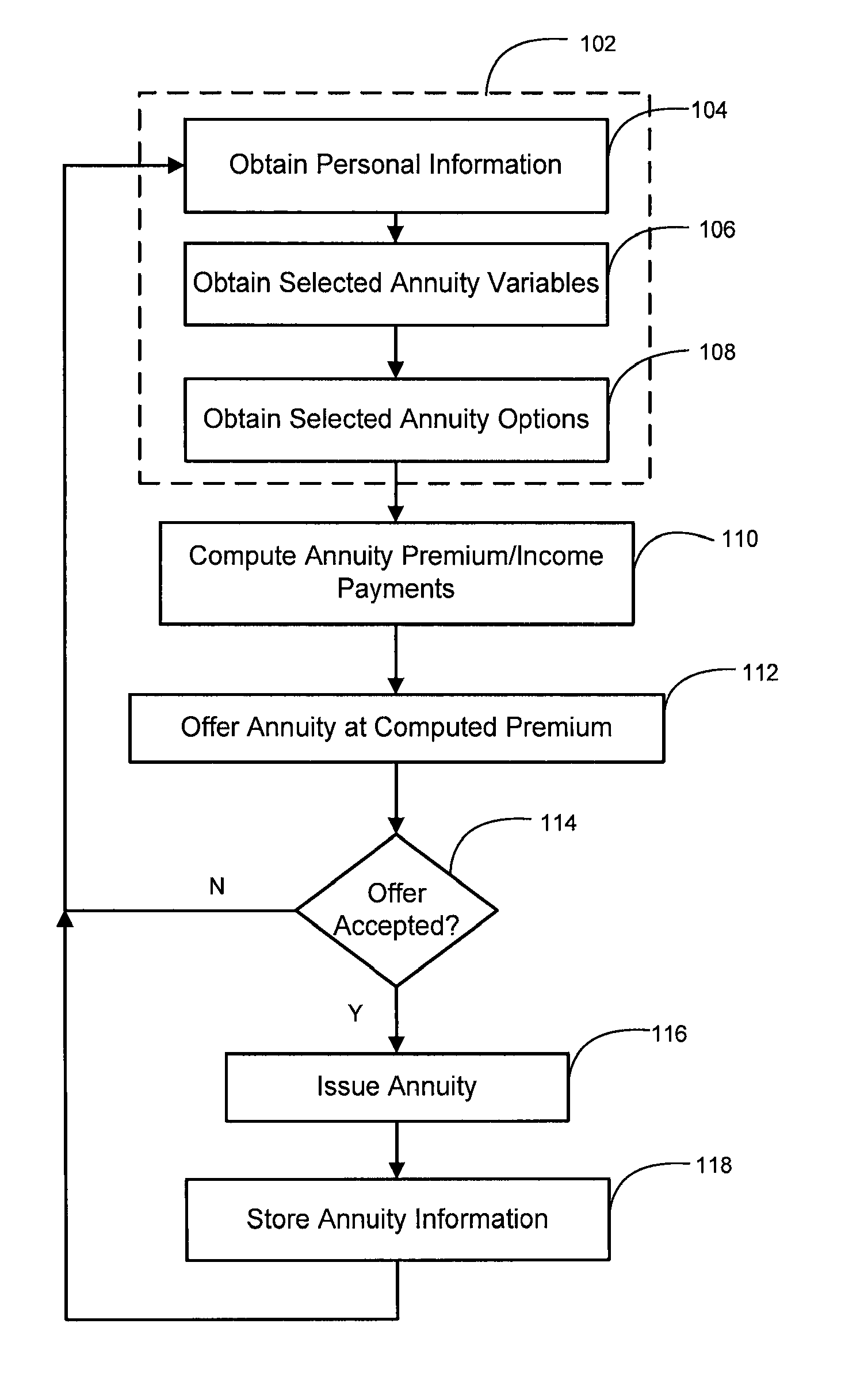

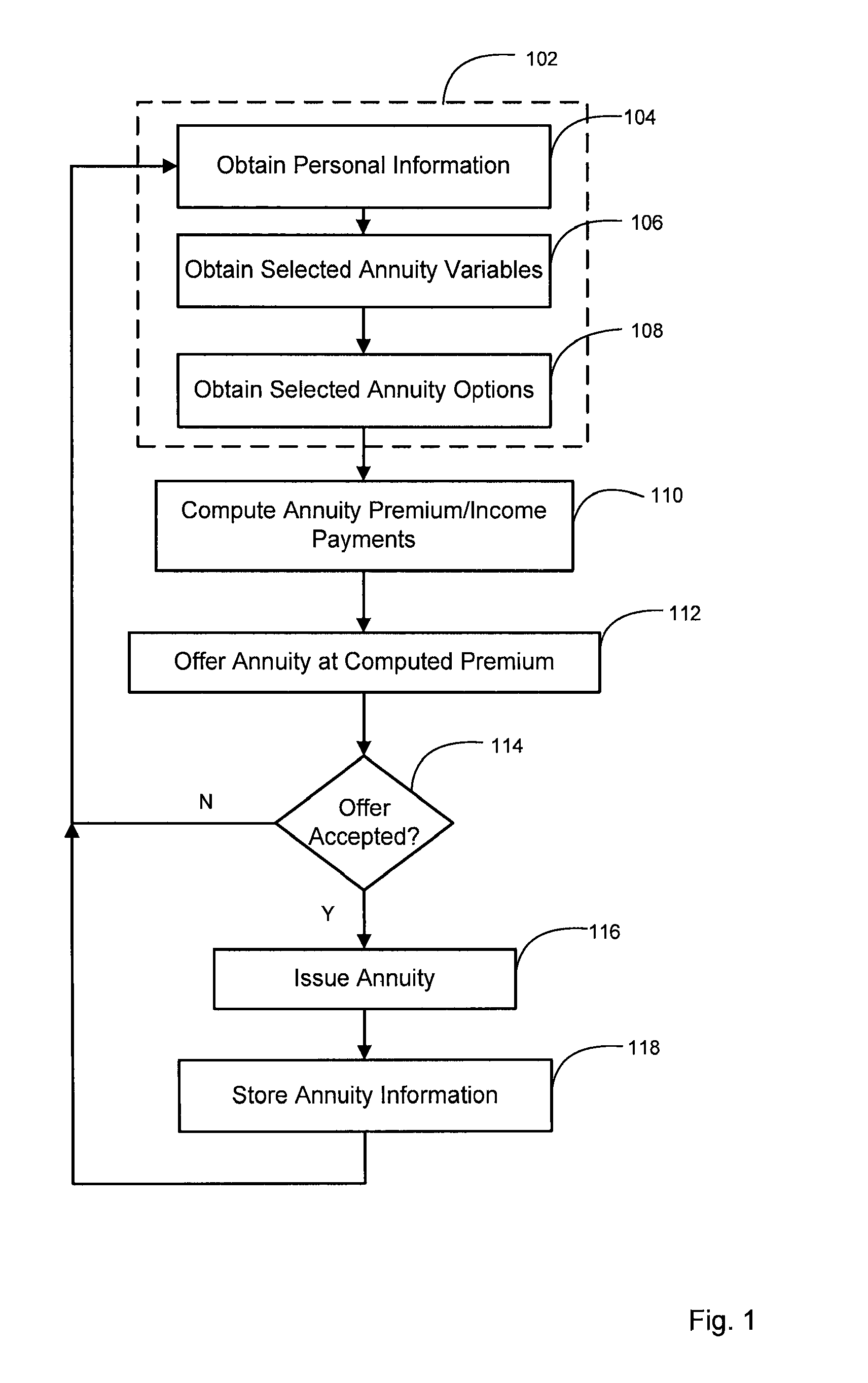

Method and apparatus for providing retirement income benefits

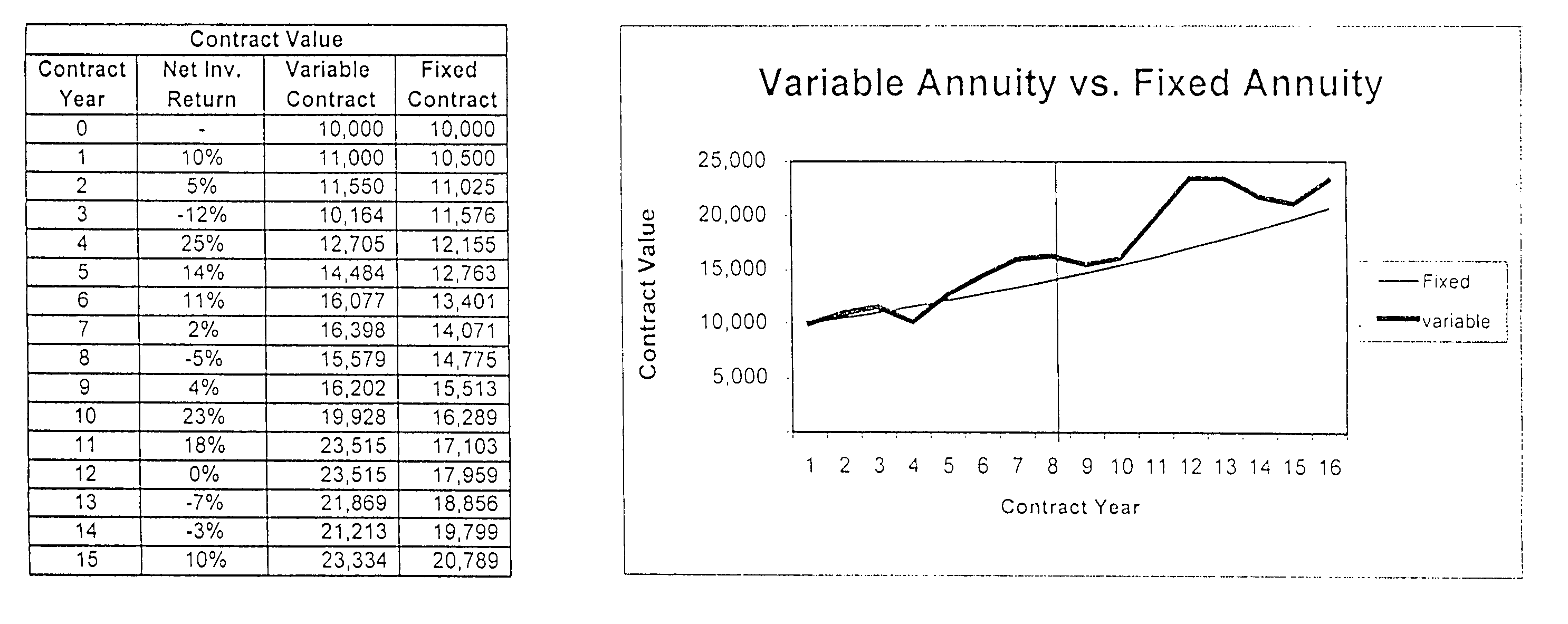

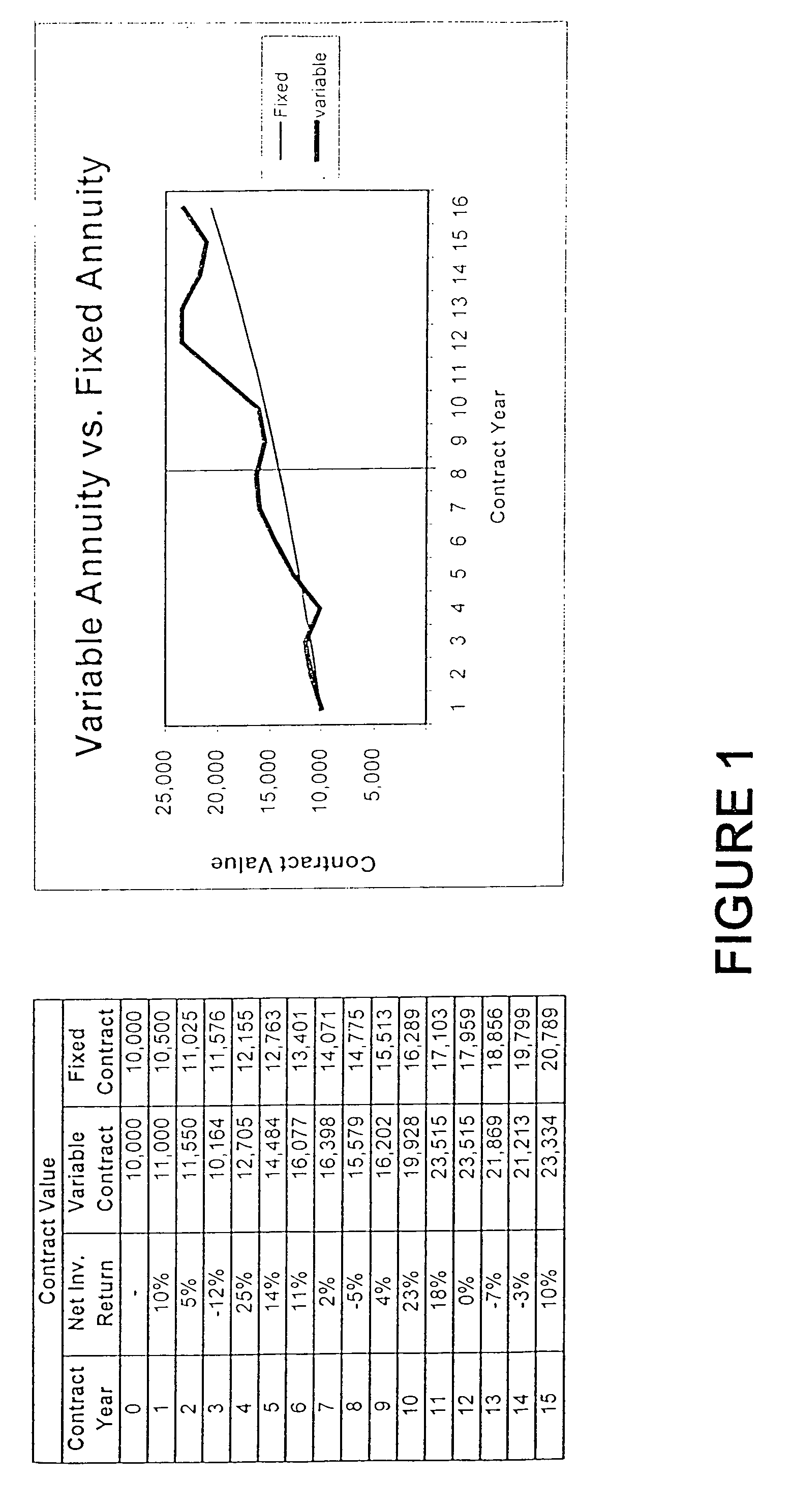

Computerized methods for administering variable annuity plans are disclosed. In certain embodiments, minimum payment features and mechanisms for adjusting current payments in response to cumulative payment totals are provided. Other embodiments provide withdrawal features under which certain guarantees are provided if withdrawals do not exceed predetermined withdrawal rates.

Owner:LINCOLN NAT LIFE INSURANCE

Methods for creating, issuing, managing and redeeming annuity-based retirement funding instruments

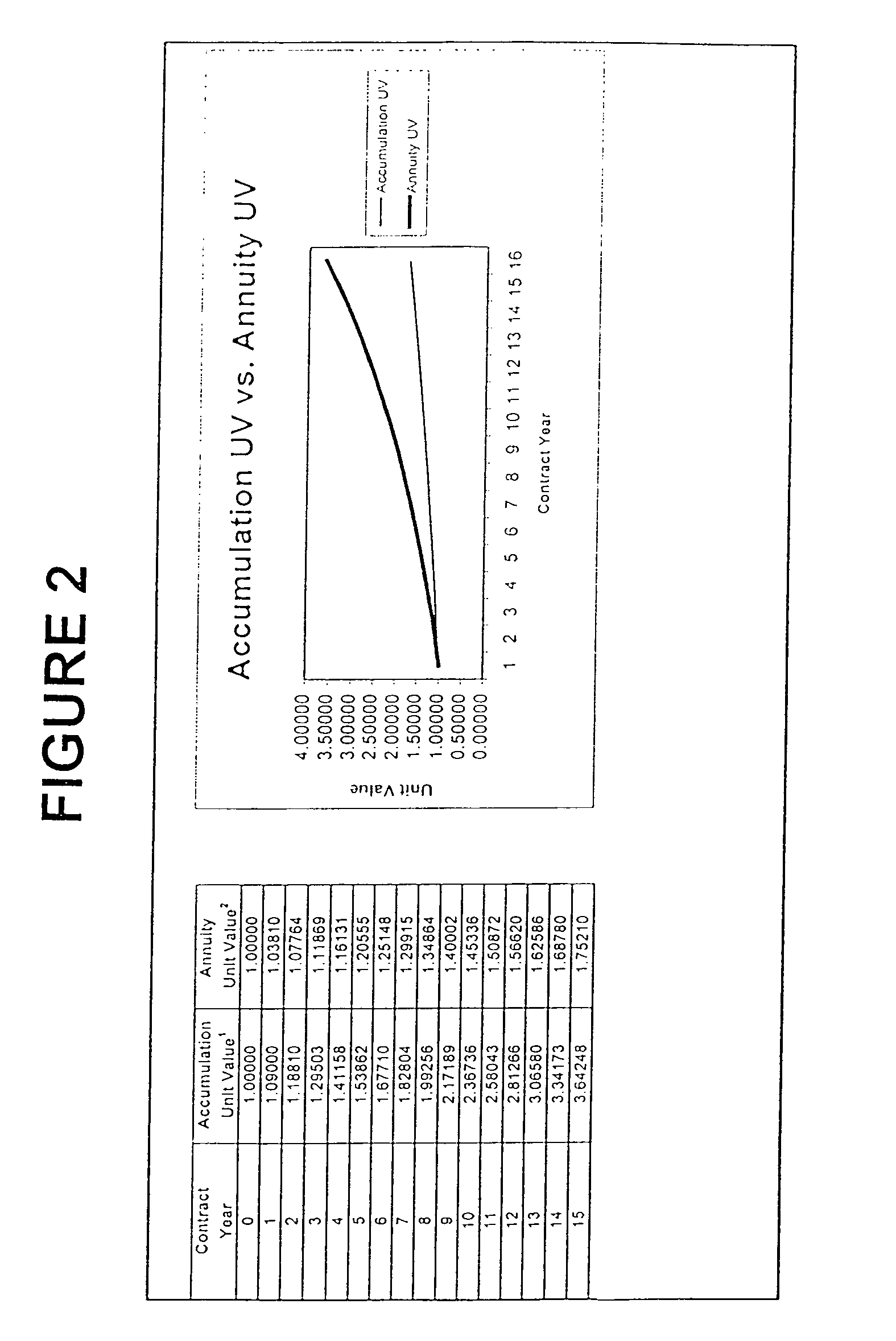

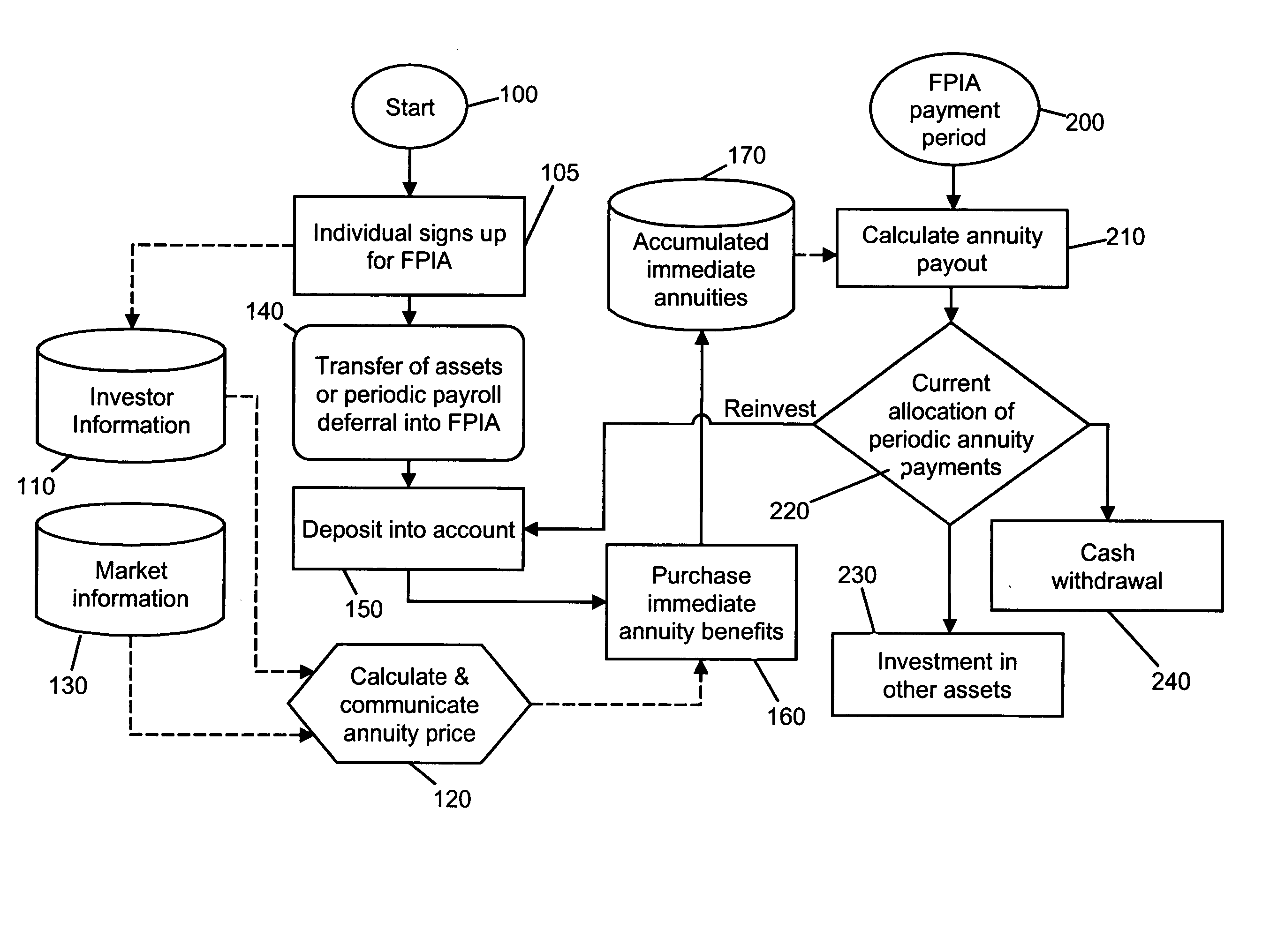

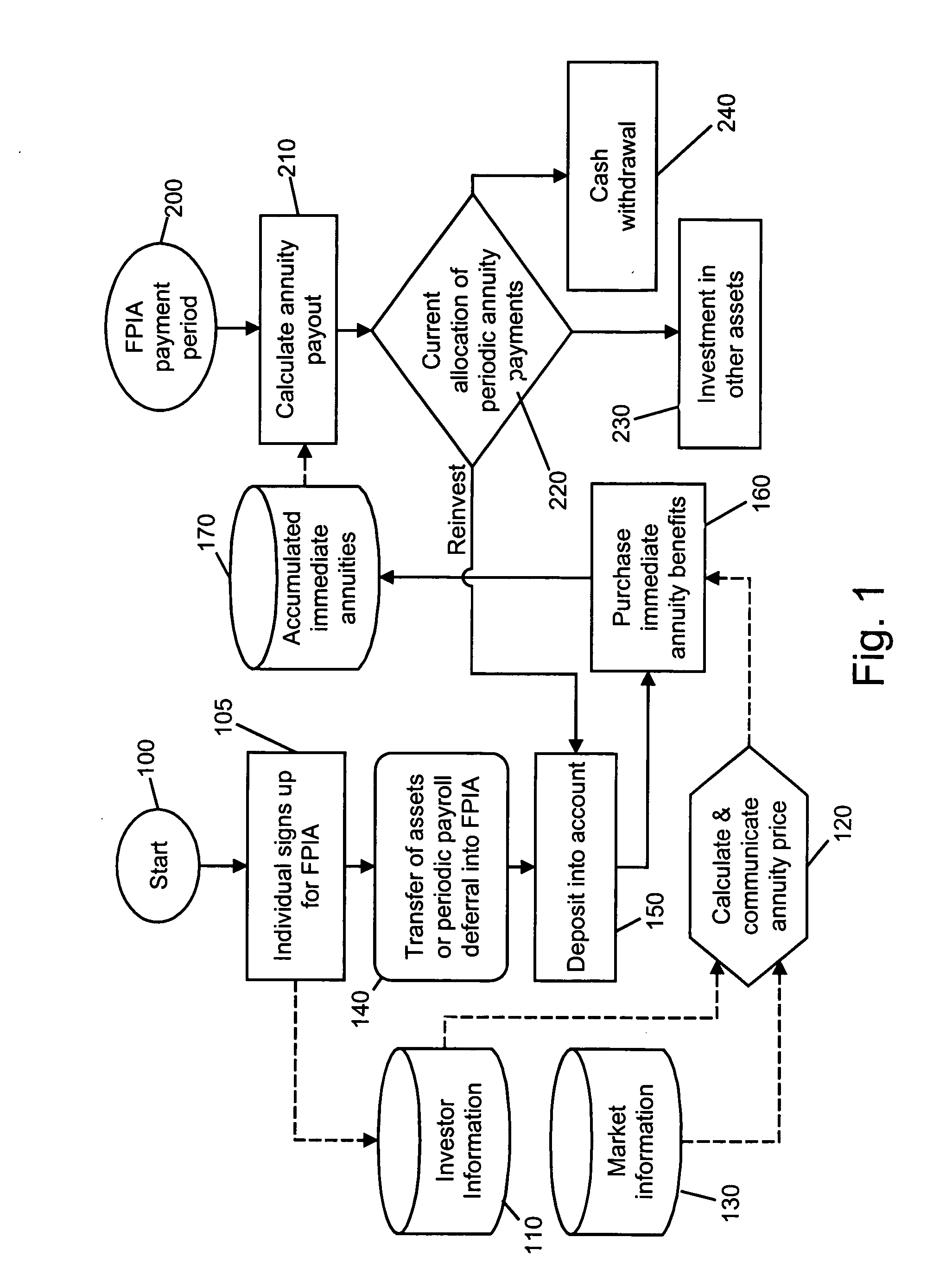

A method for administering an annuity-based retirement funding in which an investor's funds or current income is used to make incremental purchases of immediate annuity benefits at market rates, with the annuity payments received from previous purchases being applied purchase additional annuity benefits. The investor allocates a first allocated portion of each received benefit into an account and the reinvested funds are thereafter available in combination with new investment payments from the investor for the purchase of additional immediate annuity benefits. At the direction of the investor, typically after retirement, all or part of the received annuity payments can be received for the use of the investor.

Owner:RETIREMENT ENG

Computer assisted and/or implemented process and architecture for administering an investment and/or retirement program

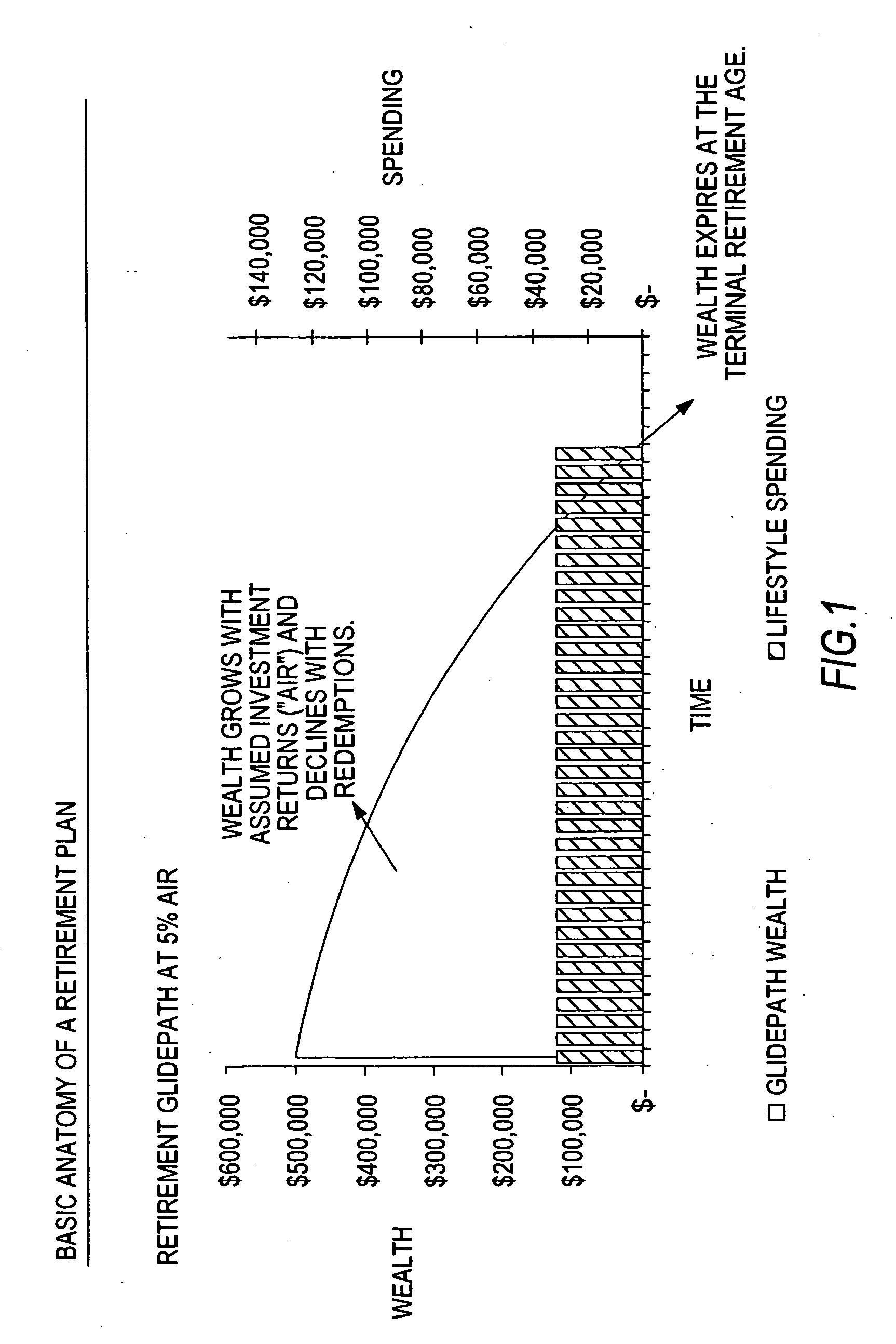

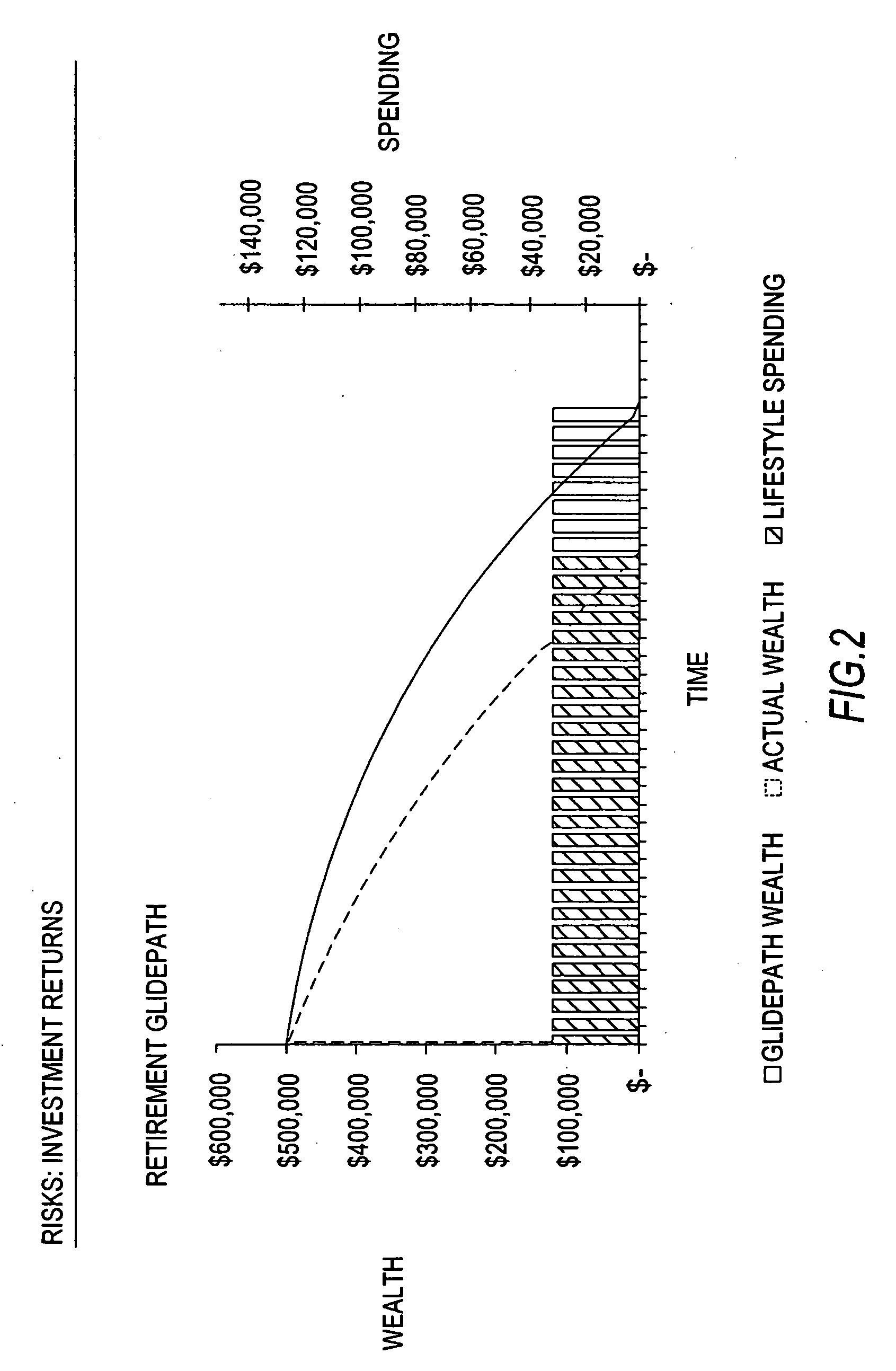

InactiveUS6085174AOptimize or maximize retirement and/or investment resourcesTracking performanceFinancePayment architectureProgram planningComputer-aided

A computer program product stores computer instructions therein for instructing a computer to perform a process of administering or assisting in the administration of resources of a customer for the benefit of a beneficiary. The program product includes a recording medium readable by the computer, and computer instructions stored thereon instructing the computer to perform the process. The instructions and the process include receiving a request from the customer to administer the resources in accordance with predetermined criteria, and storing customer related data associated with the customer. The instructions and process also include determining a predetermined period of time based on an age of the beneficiary at which withdrawals do not incur a tax penalty, and administering the resources in an annuity investment growing tax deferred in accordance with withdrawal criteria, and preventing withdrawal of the resources responsive to the withdrawal criteria.

Owner:EDELMAN FINANCIAL SERVICES

Method and system for providing retirement income benefits

A computerized method of administering an annuity product having a withdrawal feature and a guarantee comprises the steps of establishing an annuity account from which withdrawals can be made, inputting data relating to the annuity account, paying withdrawals to the account owner, and providing a guarantee. Inputted data relating to the account includes a maximum withdrawal rate for a given withdrawal frequency. The guarantee provides that, even if the account value is exhausted before the end of a specified time period, amounts up to the maximum withdrawal will continue to be paid for the specified period, provided that withdrawals before the account value is exhausted do not exceed the maximum rate. The specified time period may be a lifetime period, a period of years or months chosen by the account owner when the account is established, or a period during which withdrawals at least equal a specified percentage of the account value, or a highest account value achieved, as of a specified date. The method may further include the step of establishing a charge to pay for the guarantee.

Owner:LINCOLN NAT LIFE INSURANCE

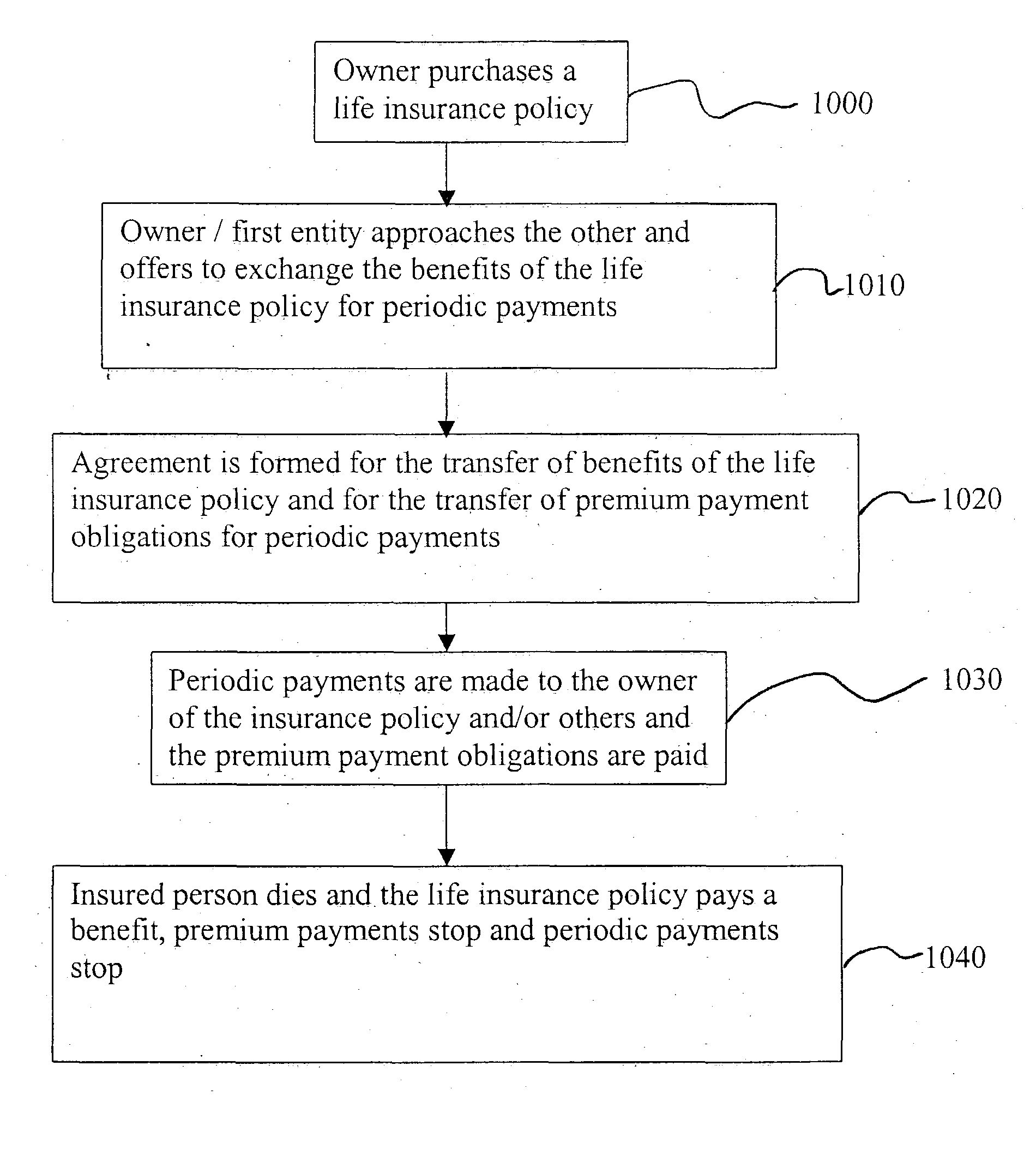

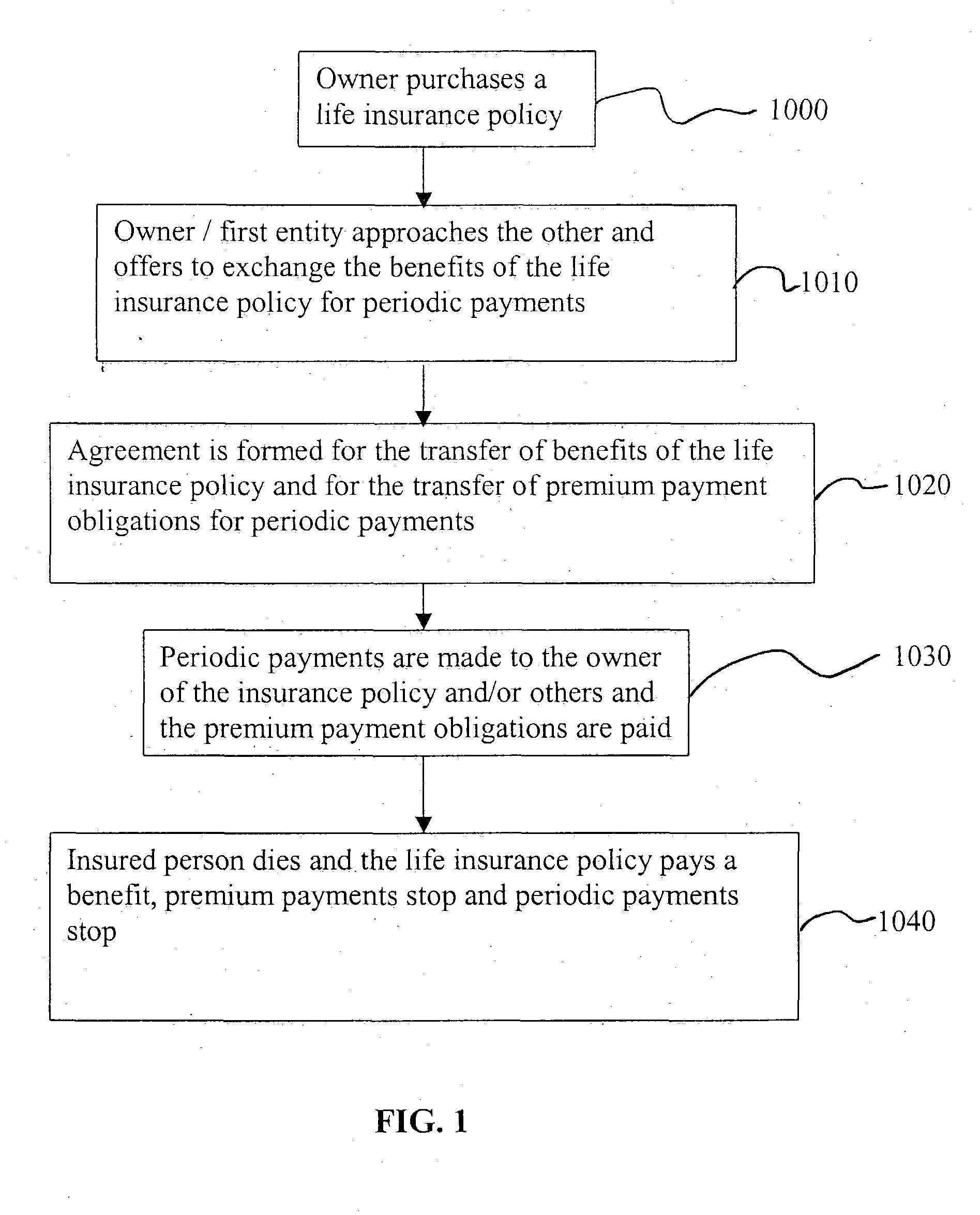

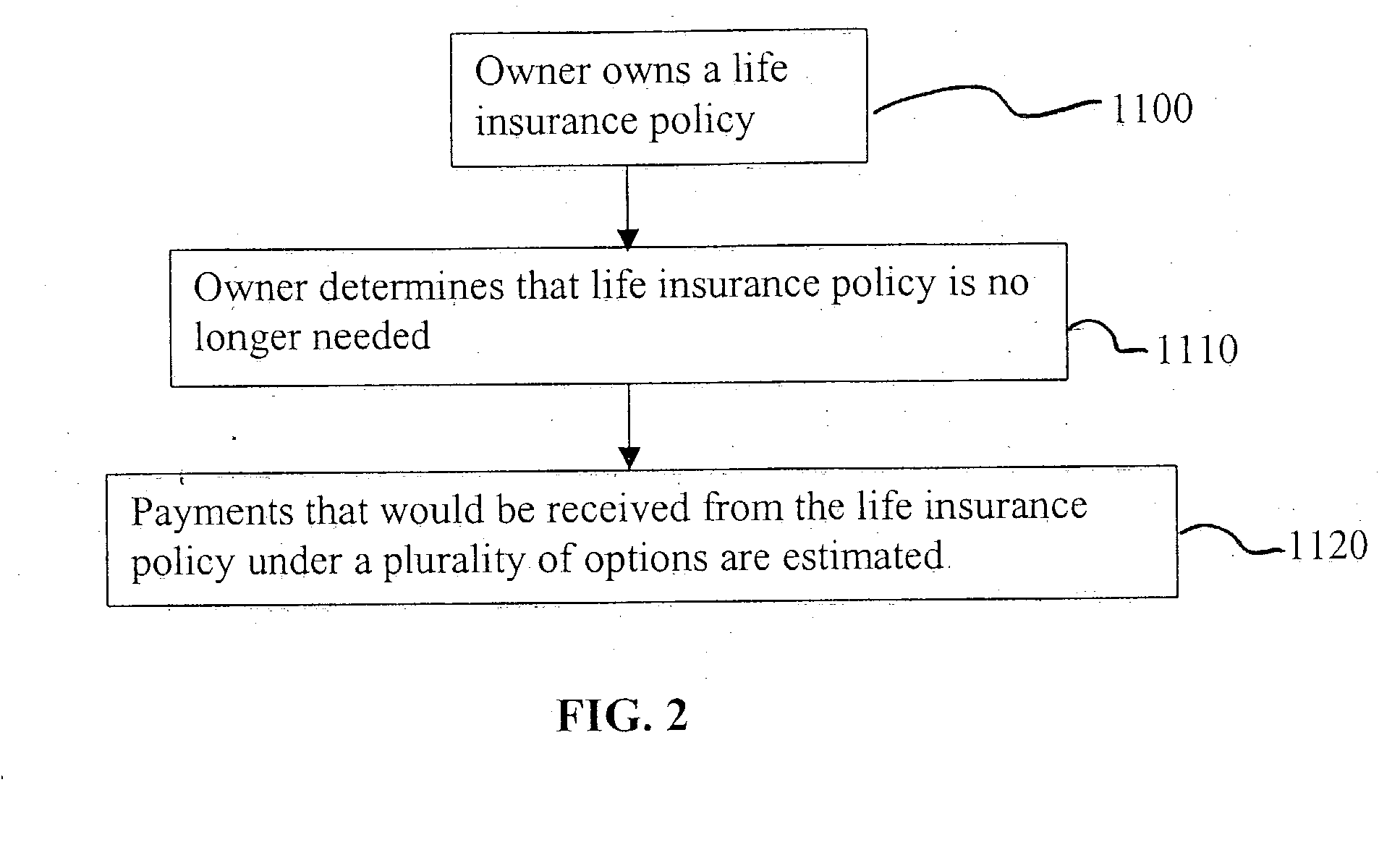

Method and system for inverse life annuity

A computer based method for investing that includes causing the formation of an agreement for the transfer of benefits of an insured's life insurance policy to a first entity and the transfer of premium payment obligations of the insured's life insurance policy to the first entity or a second entity in exchange for periodic payments for a period of time to at least one of an owner of the life insurance policy and a third entity, wherein the period of time is based on at least one of a fixed period and the life of the insured.

Owner:TERLIZZI JAMES D +1

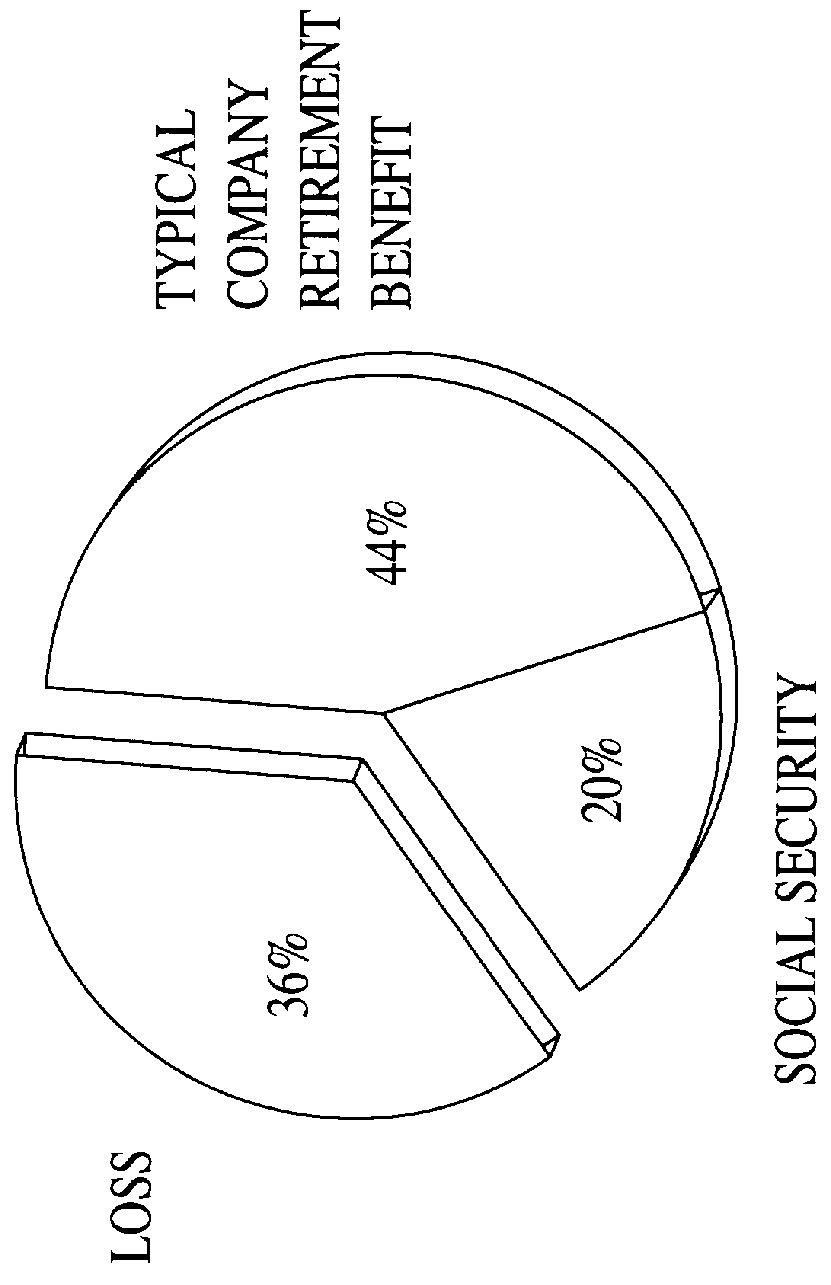

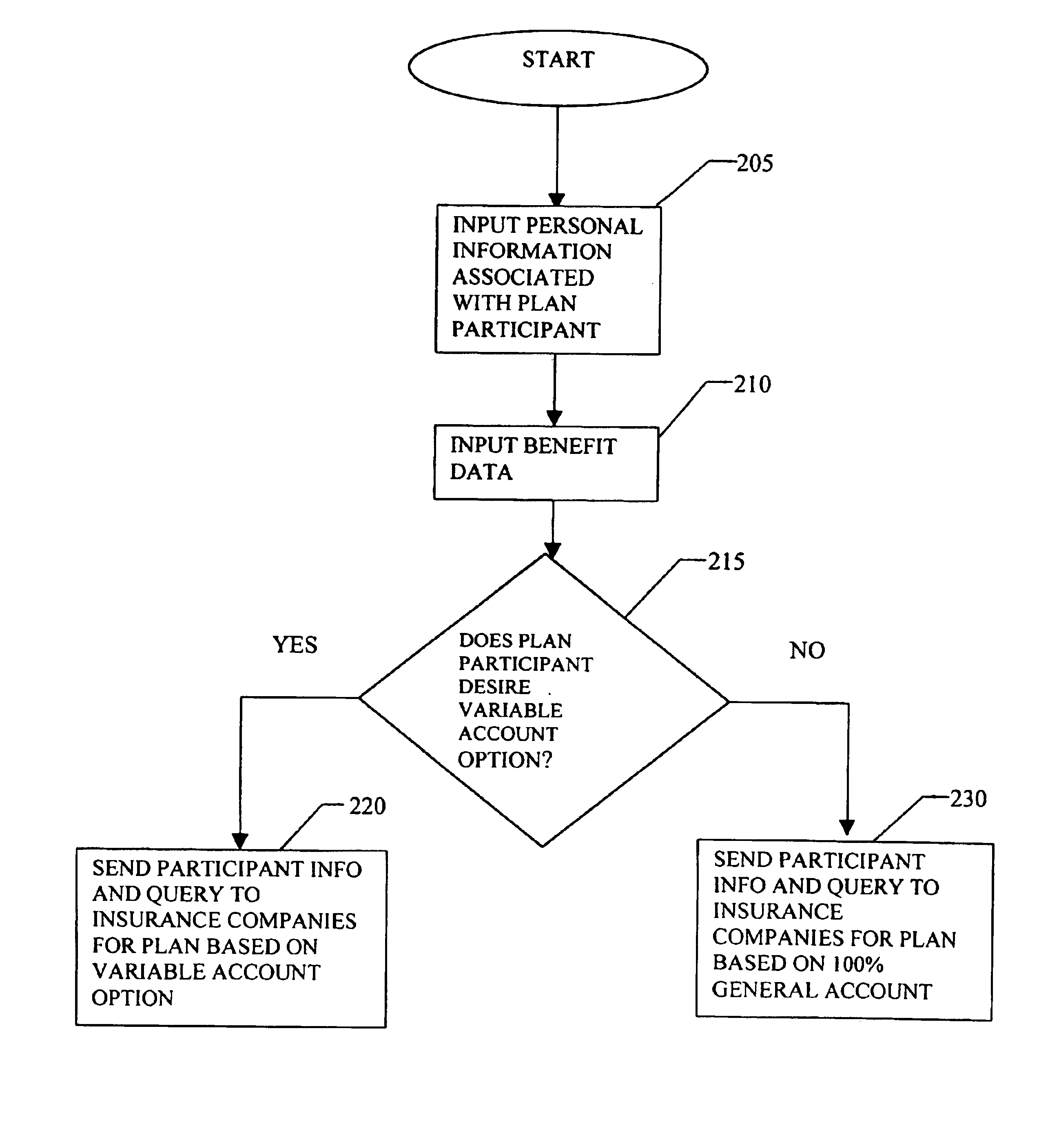

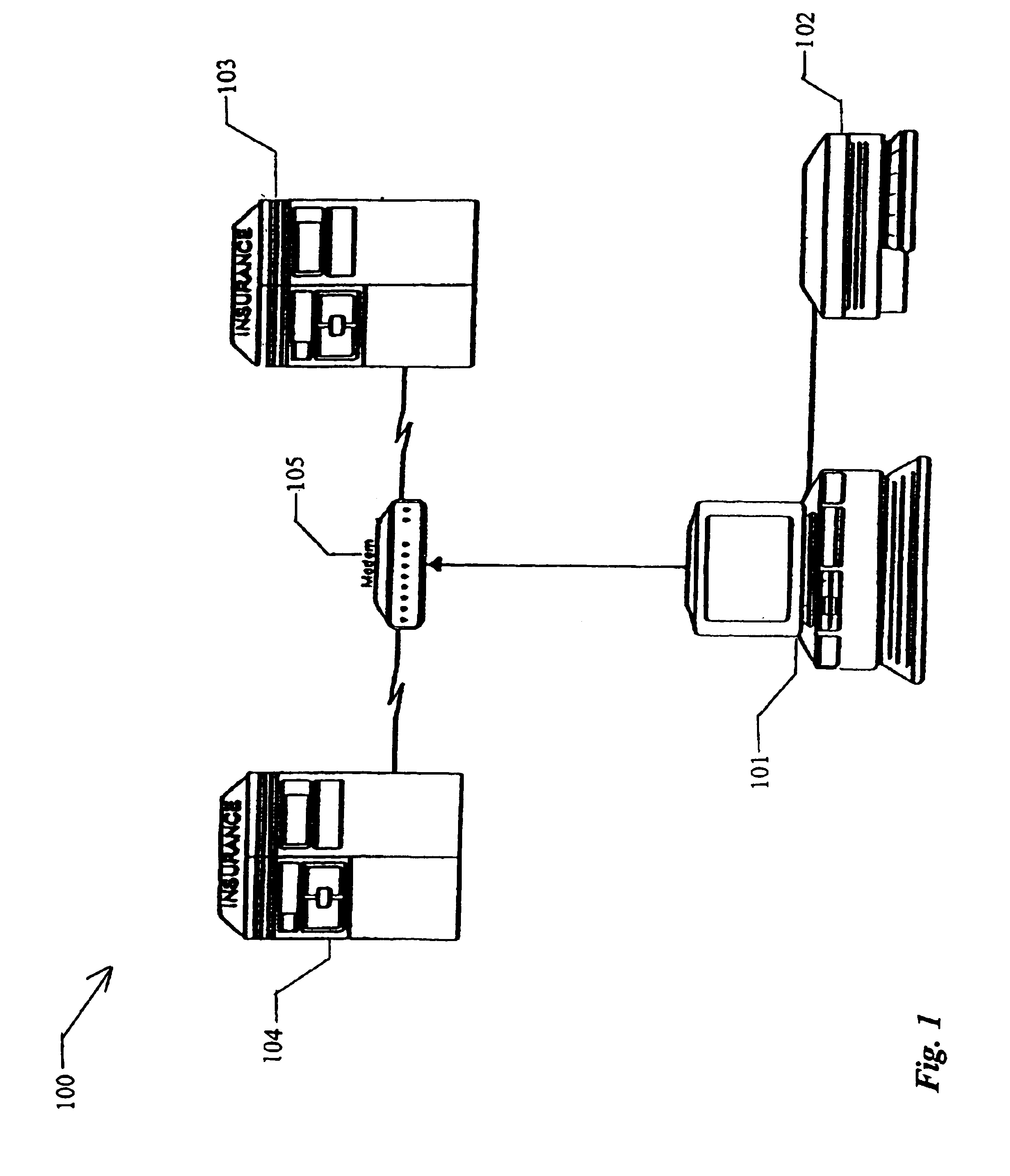

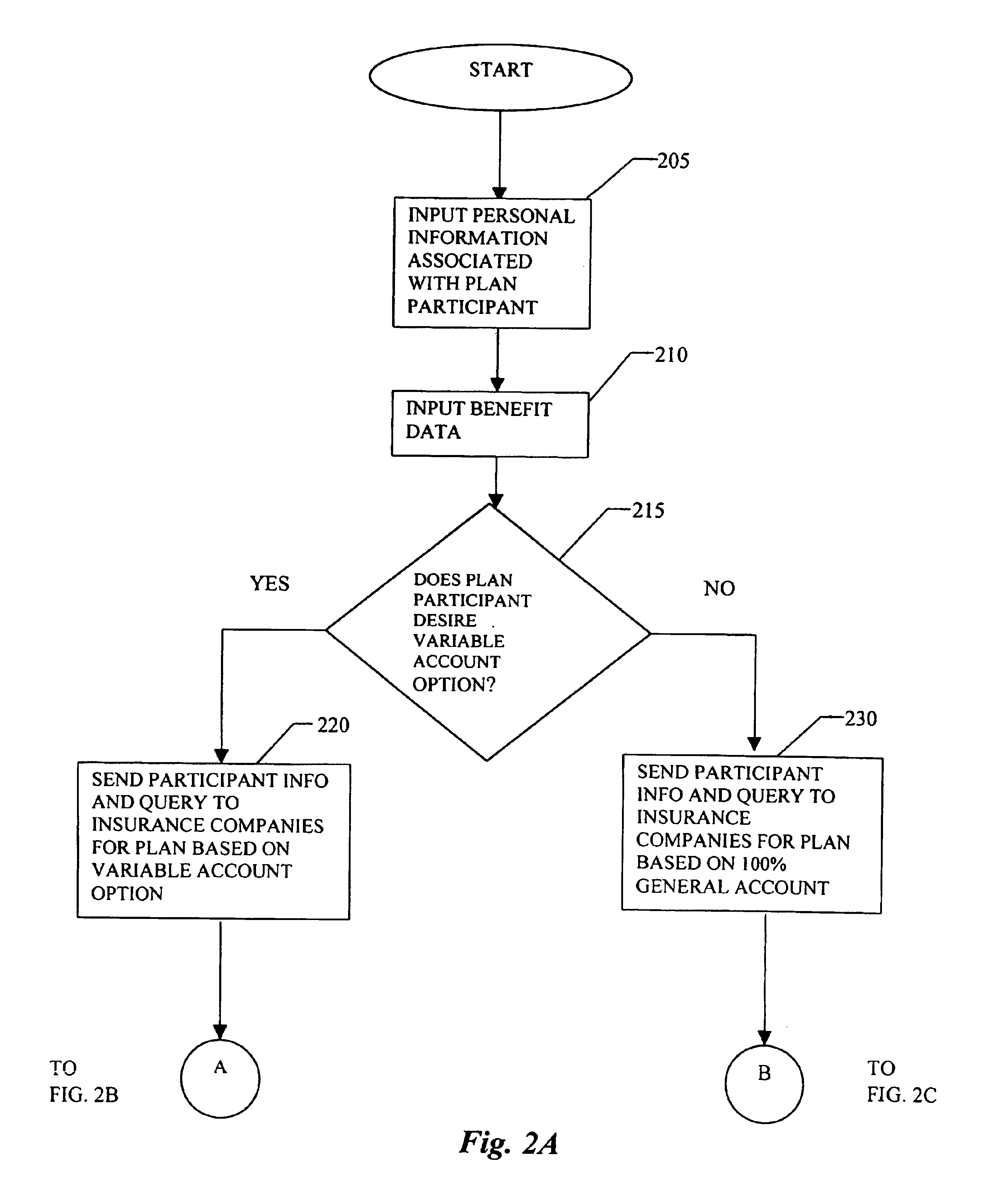

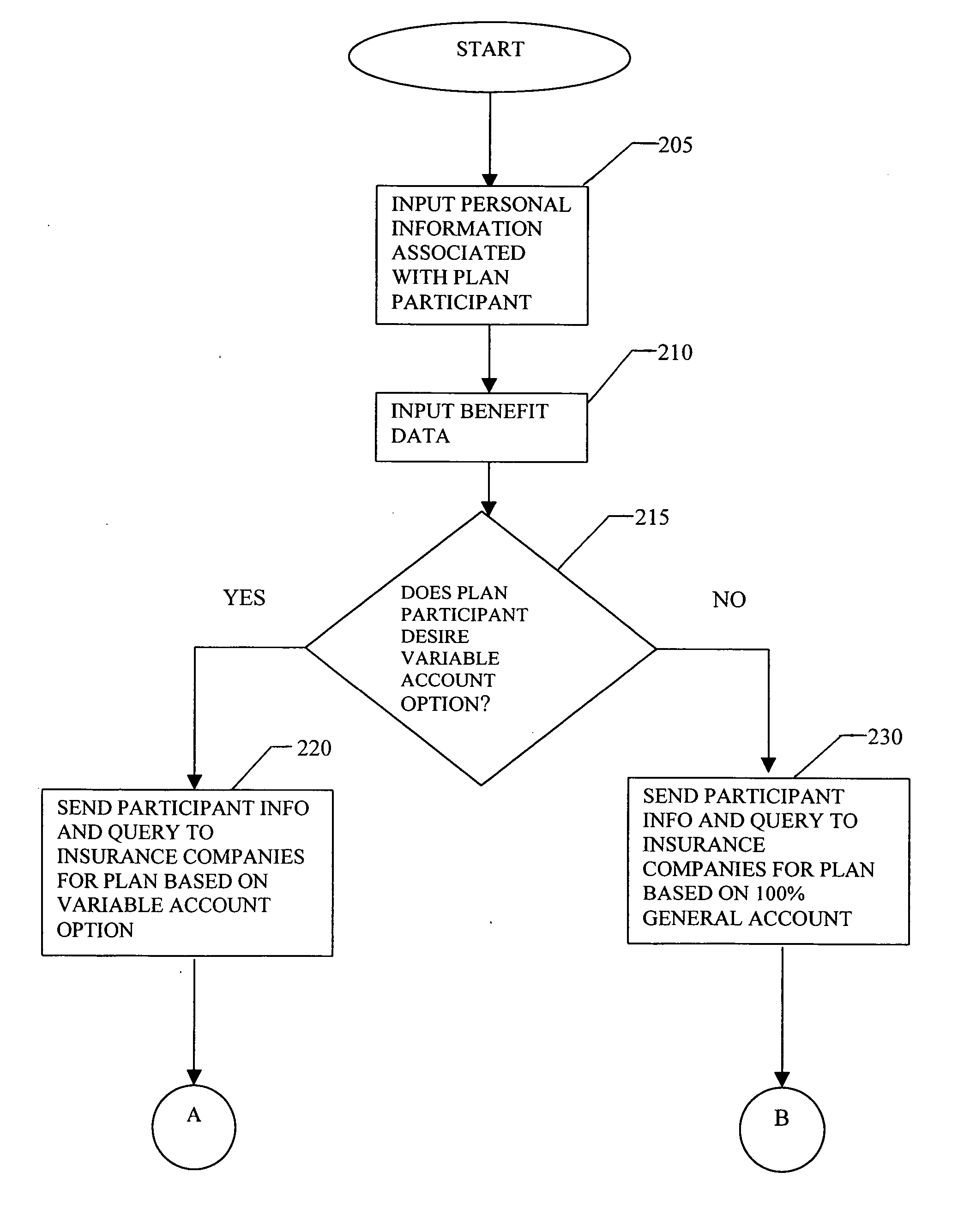

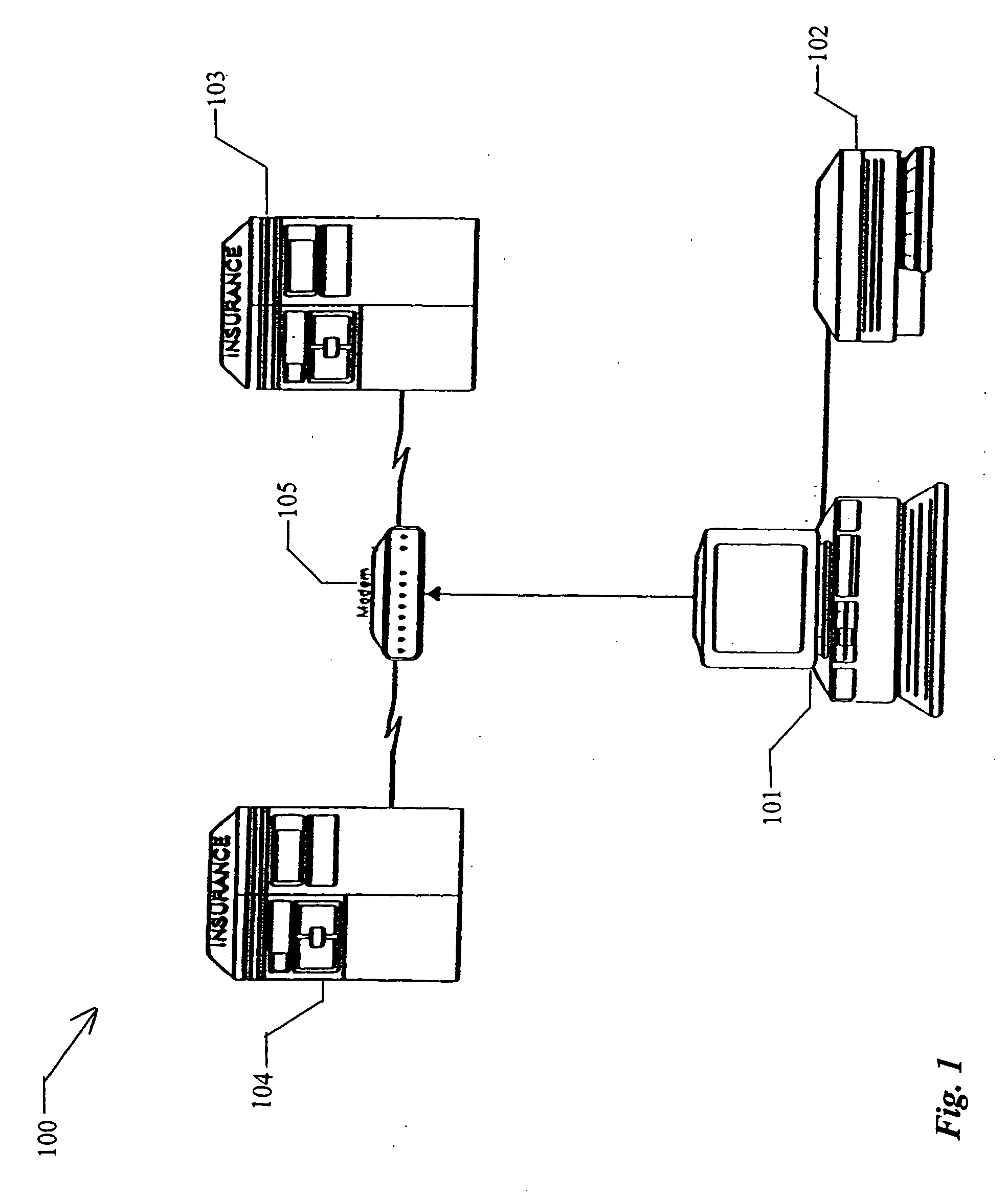

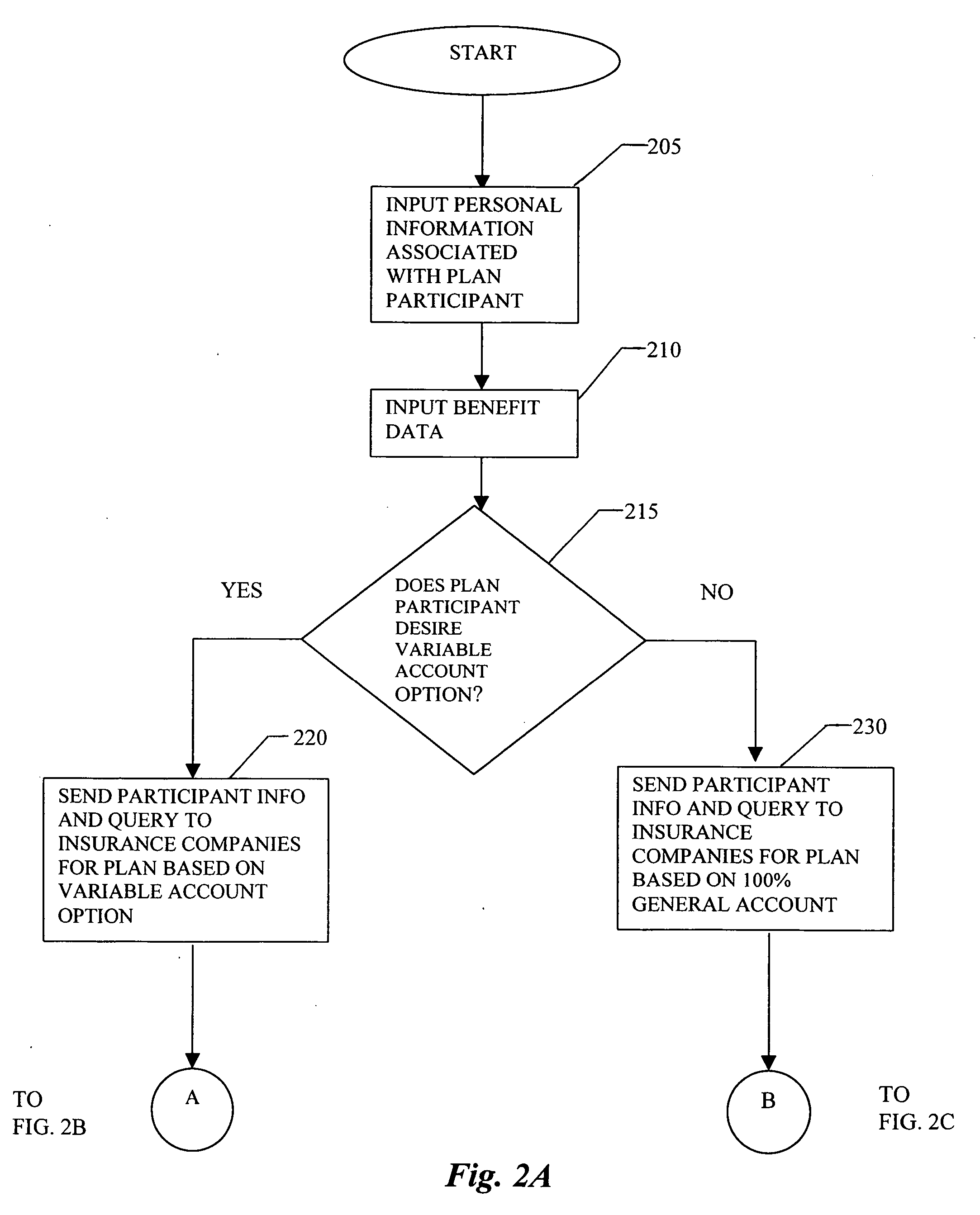

System and method for creating a defined benefit pension plan funded with a variable life insurance policy and/or a variable annuity policy

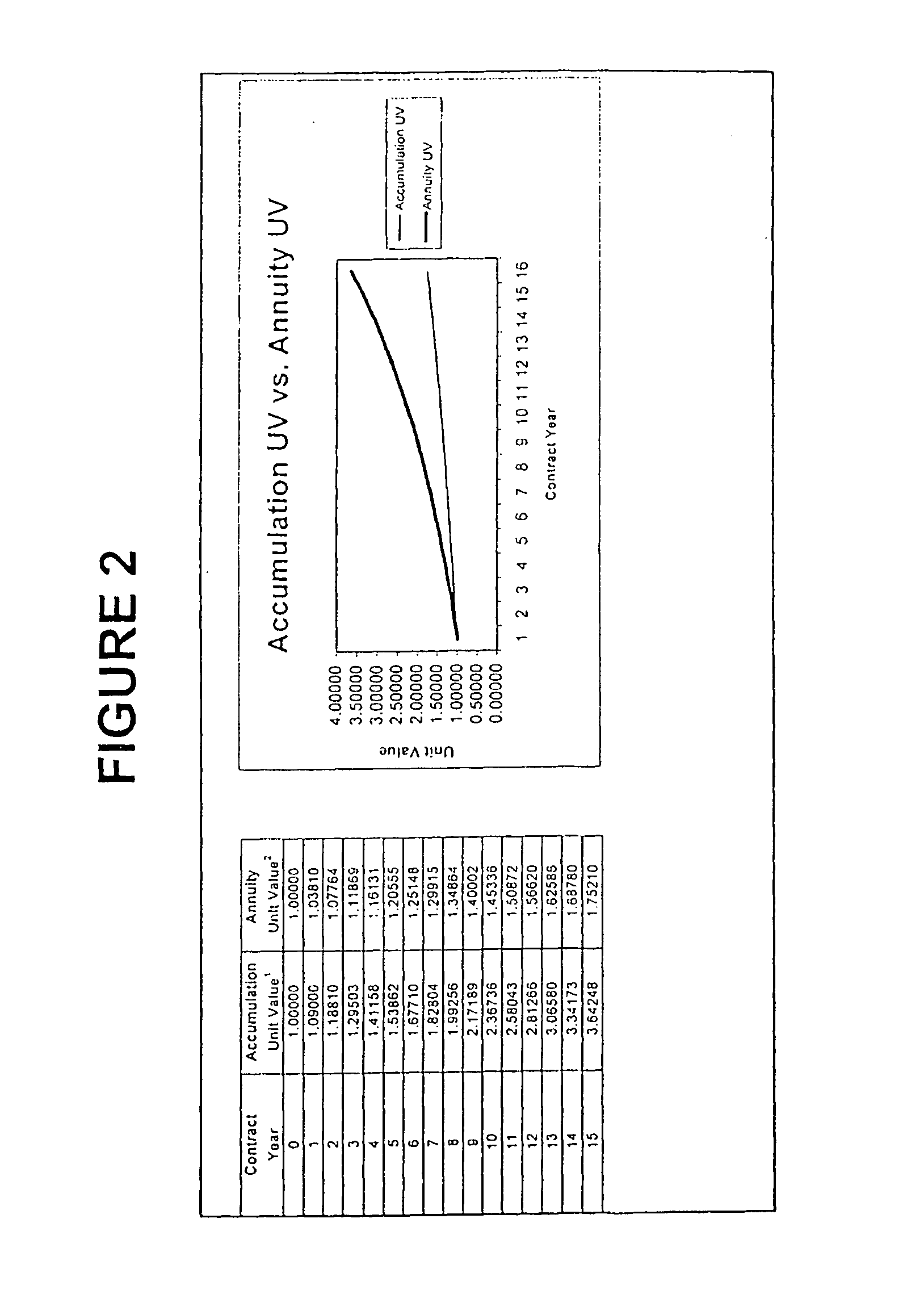

A defined benefit pension plan, such as a plan described in Internal Revenue Code Section 412(i), is created using variable life insurance contracts and / or variable annuity contracts. Actuarial data used to create the defined benefit pension plan is entered via at least one user interface and processed. Based on the actuarial data, a variable life insurance policy and / or a variable annuity policy is generated for the purpose of funding the defined benefit pension plan. Additionally, a separate agreement is created that either extra-contractually modifies the variable life insurance policy and / or the variable annuity policy, or defines the terms under which the variable life insurance policy and / or the variable annuity policy is to be used in the defined benefit pension plan. Thus, a mechanism is provided to avoid violation of the Internal Revenue Service “incidental benefit rule” and to provide a guaranteed rate of return such that the variable life insurance contracts and / or the variable annuity contracts can be used in a plan described in a retirement plan, including a plan described in Code section 412(i).

Owner:KORESKO V JOHN J

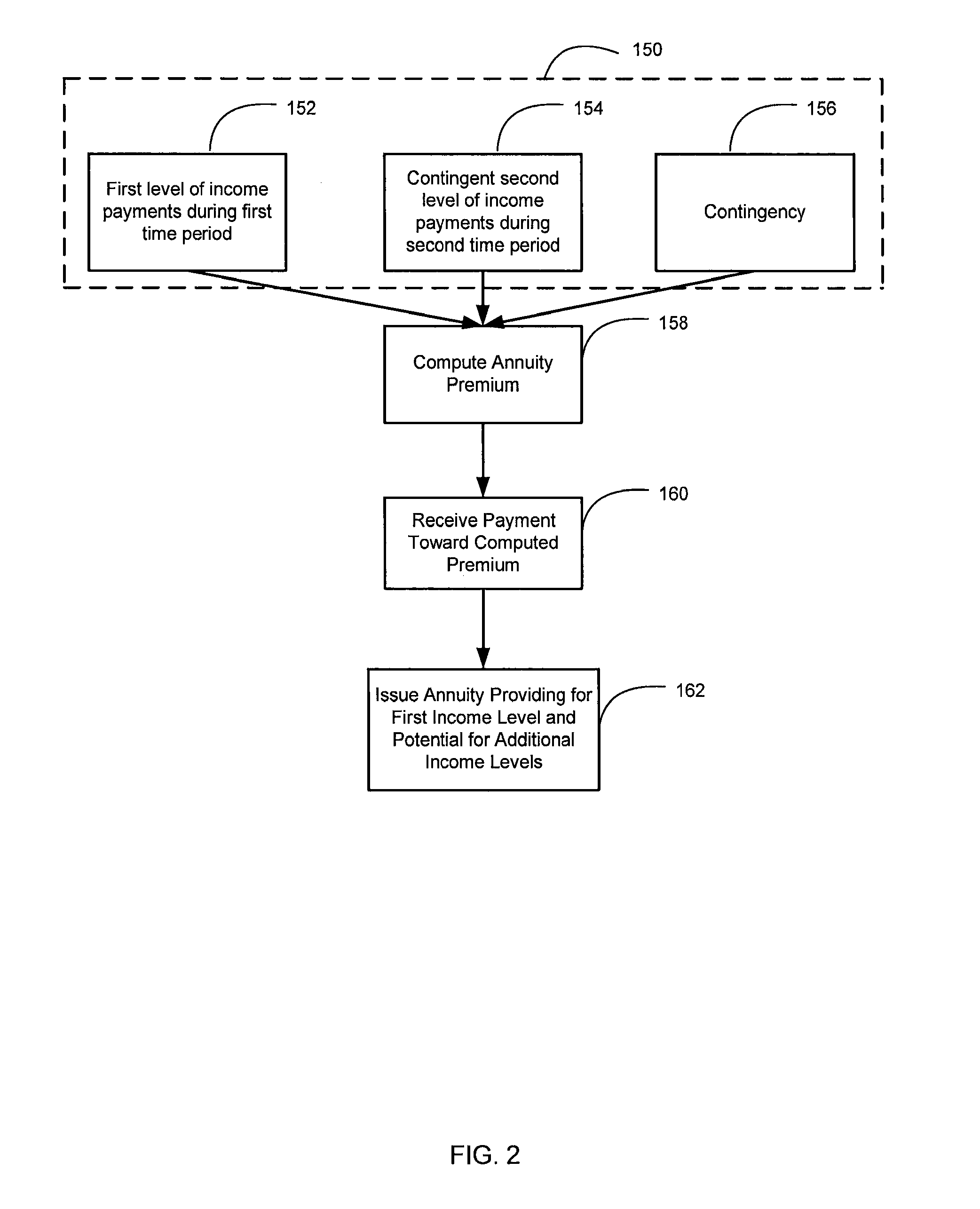

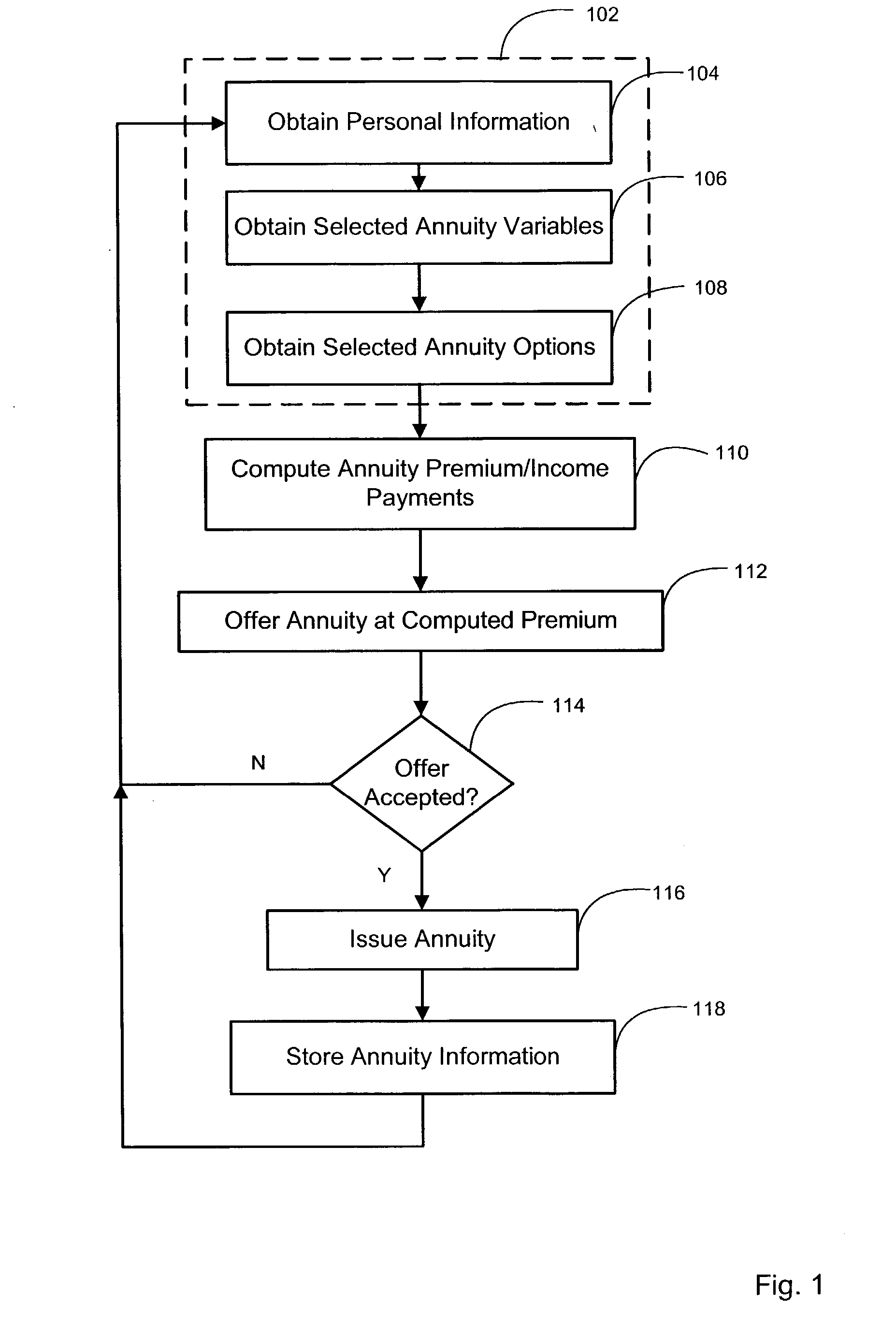

Method and system for providing flexible income, liquidity options and permanent legacy benefits for annuities

Methods and systems are described herein for providing an annuity including flexible income, liquidity options or permanent legacy benefits. Providing the annuity generally includes receiving information useful for issuing an annuity that provides for a first level of income payments during a first time period and a second level of income payments during a second time period following the first time period. The second payment level may be contingent on a first event. An annuity premium is computed to provide the first level of income payments and the contingent second level of income payments. The annuity is issued generally upon receipt of a portion of the computed premium.

Owner:NEW YORK LIFE INSURANCE COMPANY

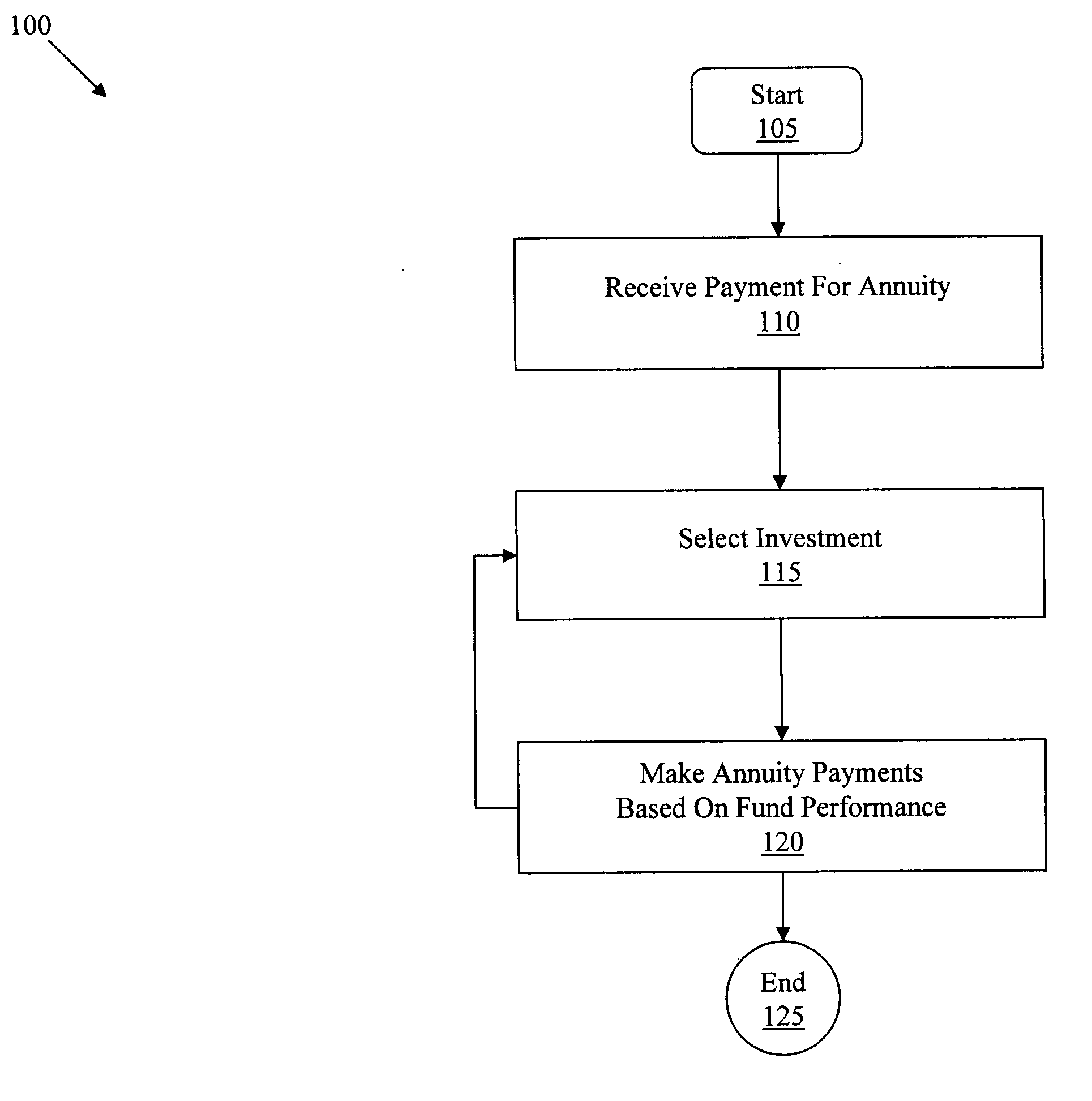

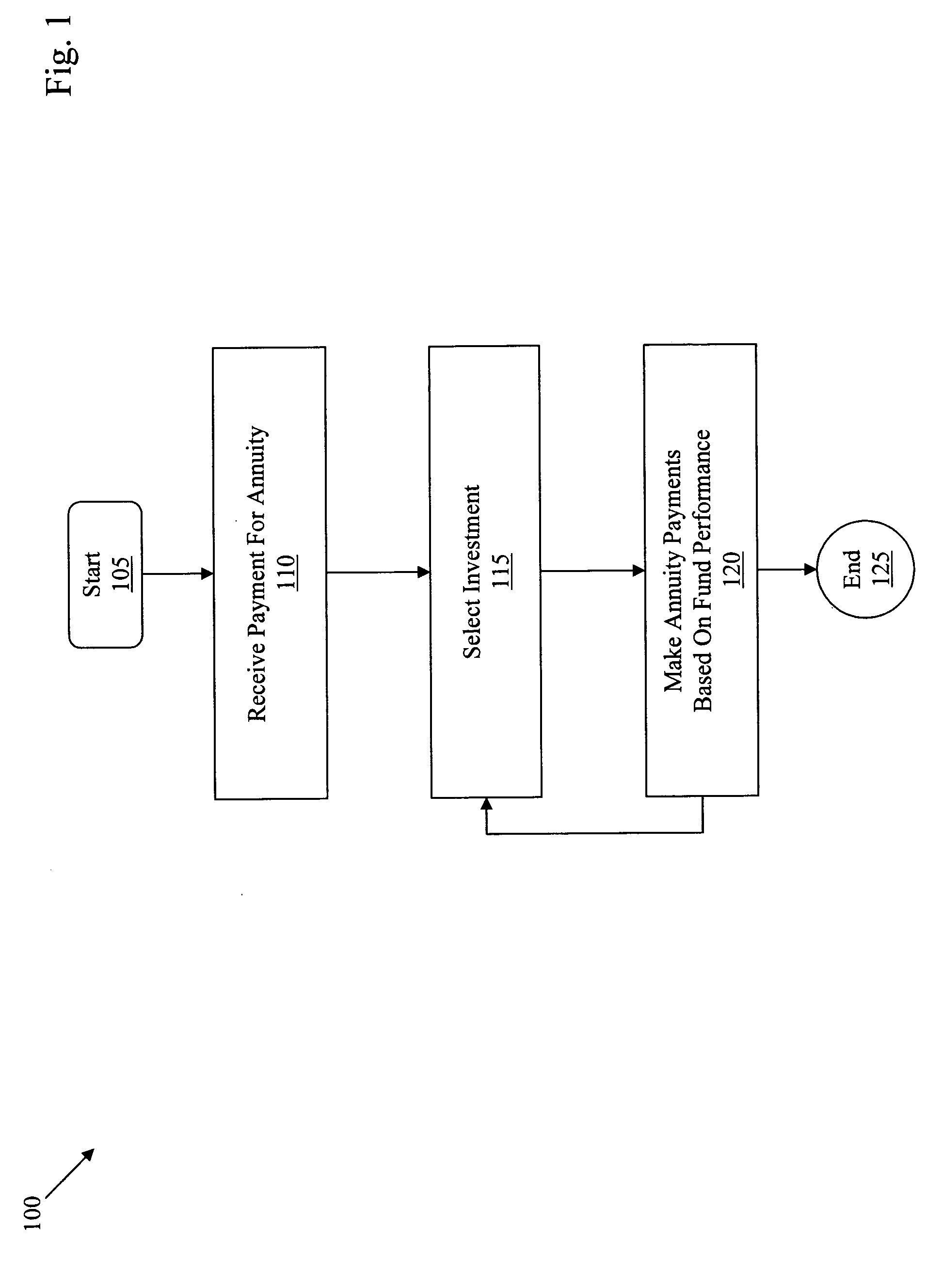

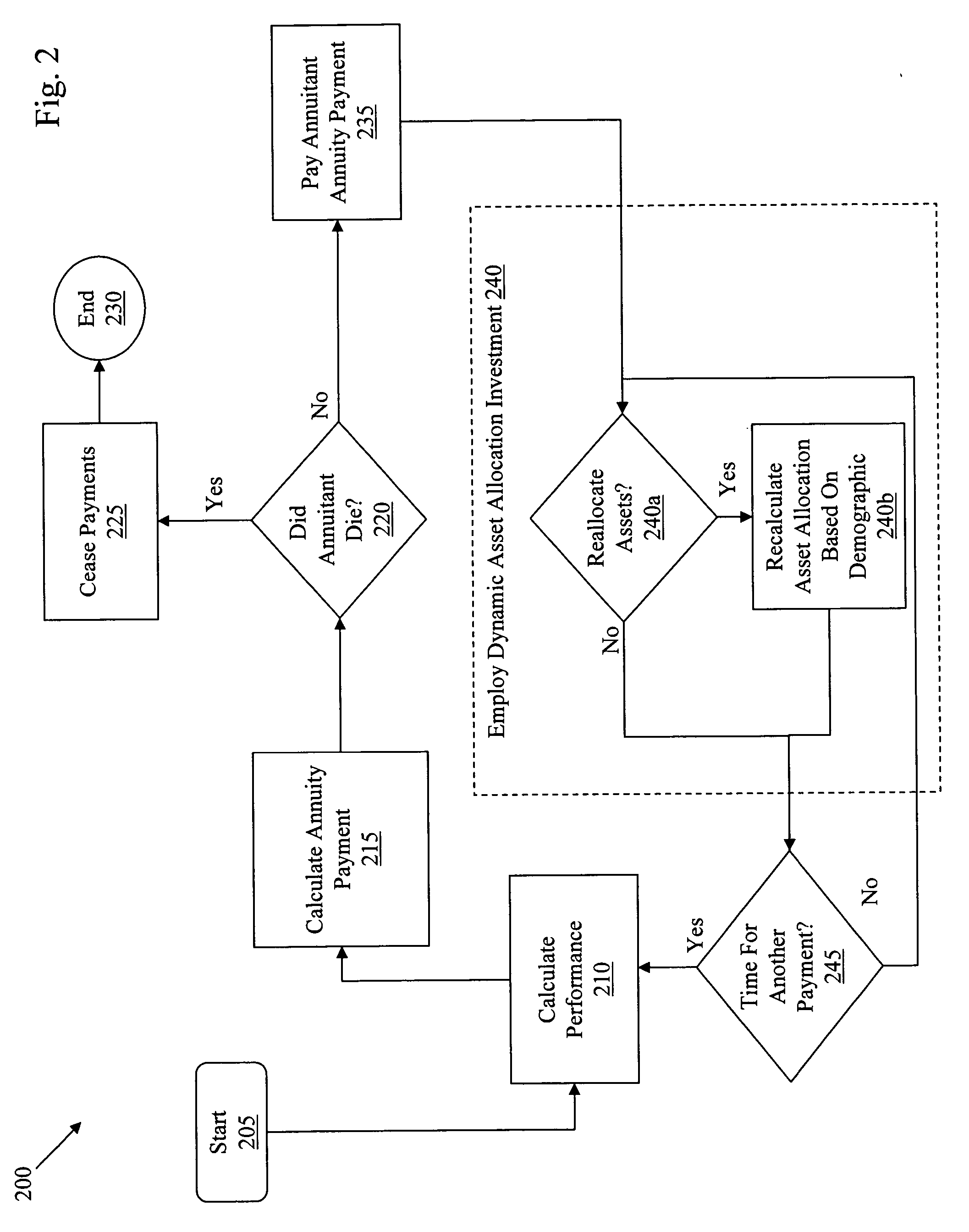

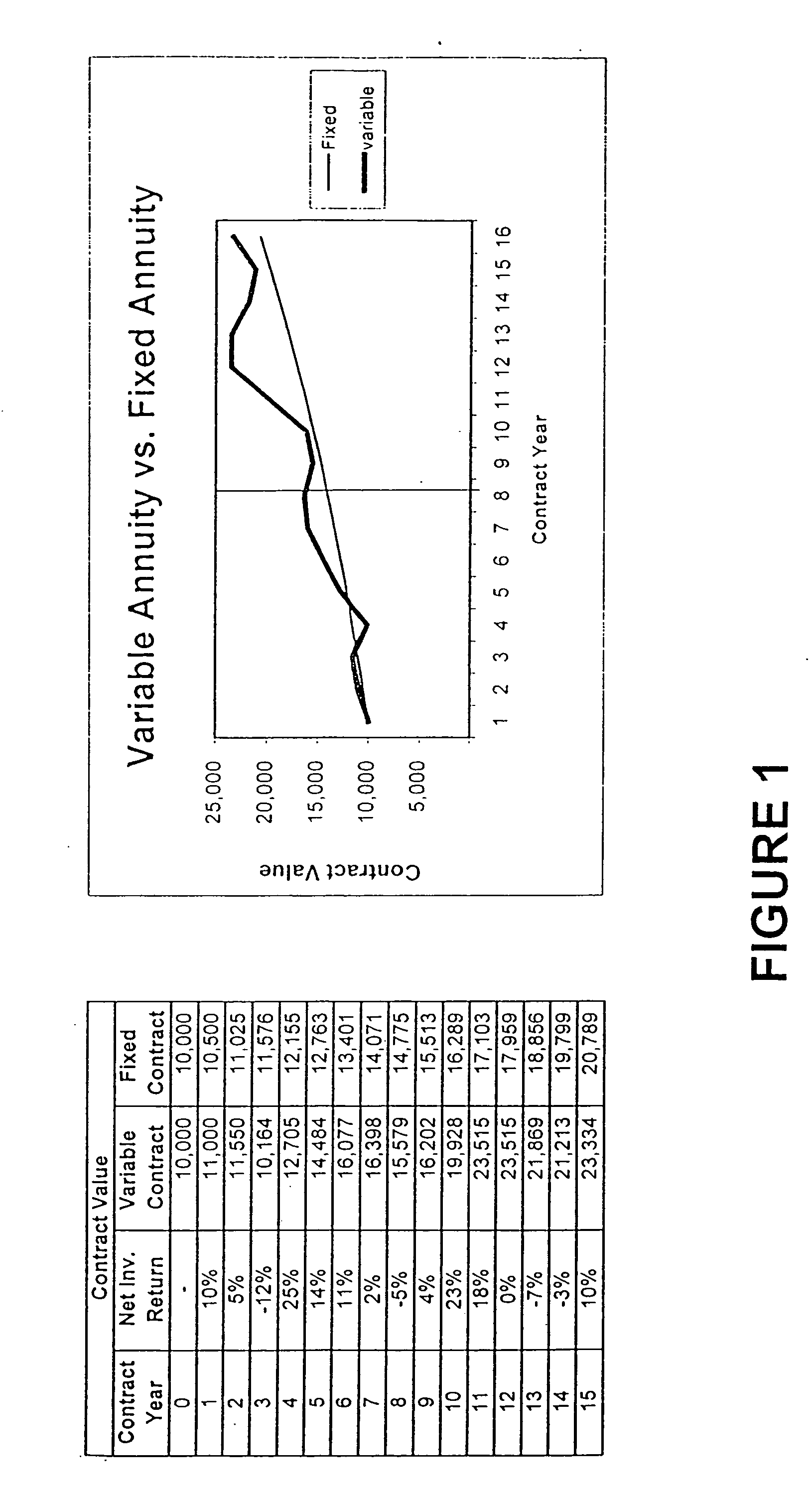

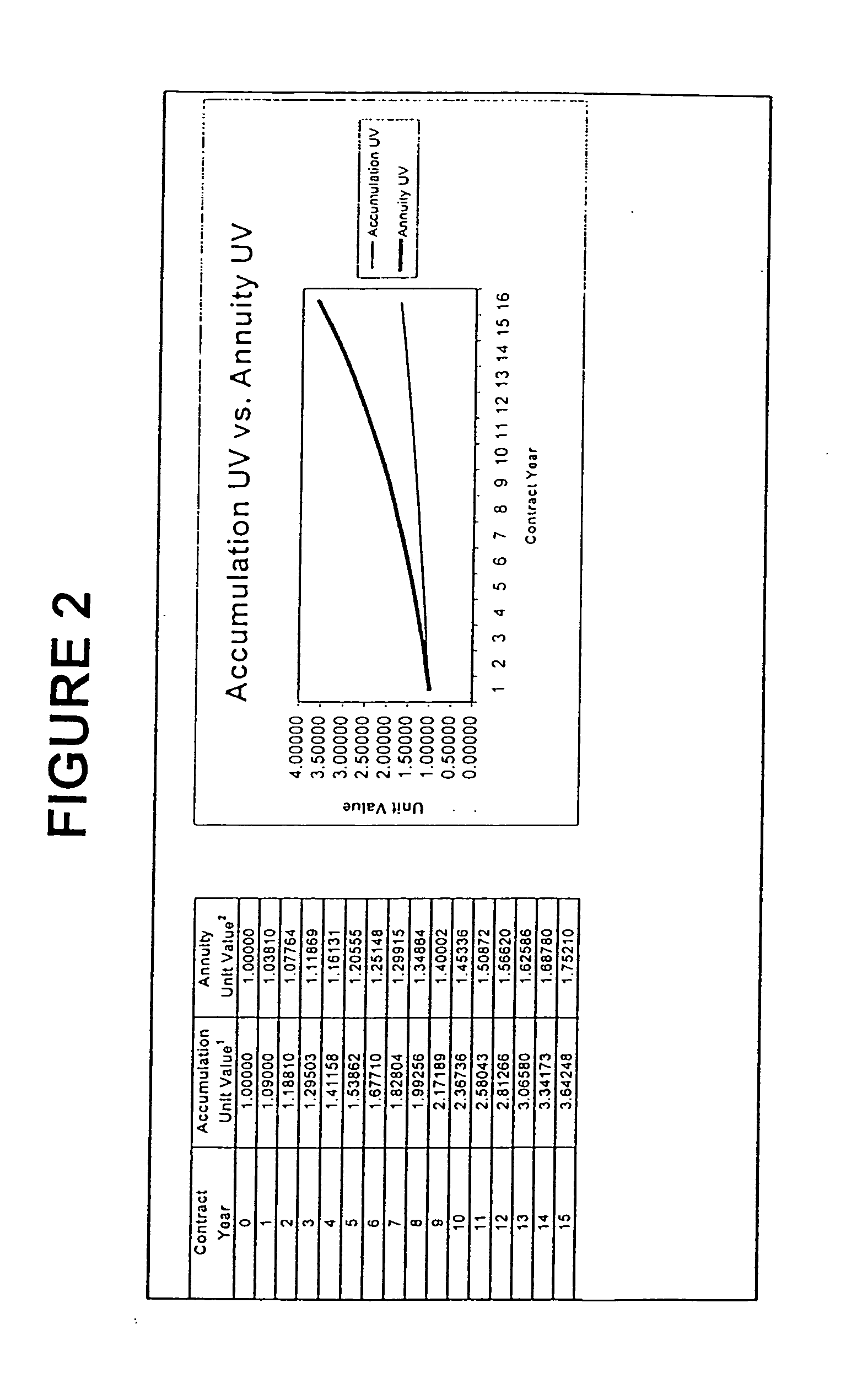

Generating an annuity payment using a dynamic asset allocation investment

An annuity is provided to an annuitant based on the performance of an investment. Assets of the investment are automatically reallocated over time and the annuity payment may change based on the performance of the automatically allocated assets. In some examples, the assets are automatically reallocated based on a demographic, which can include an age, a range of ages, and / or a gender.

Owner:FMR CORP

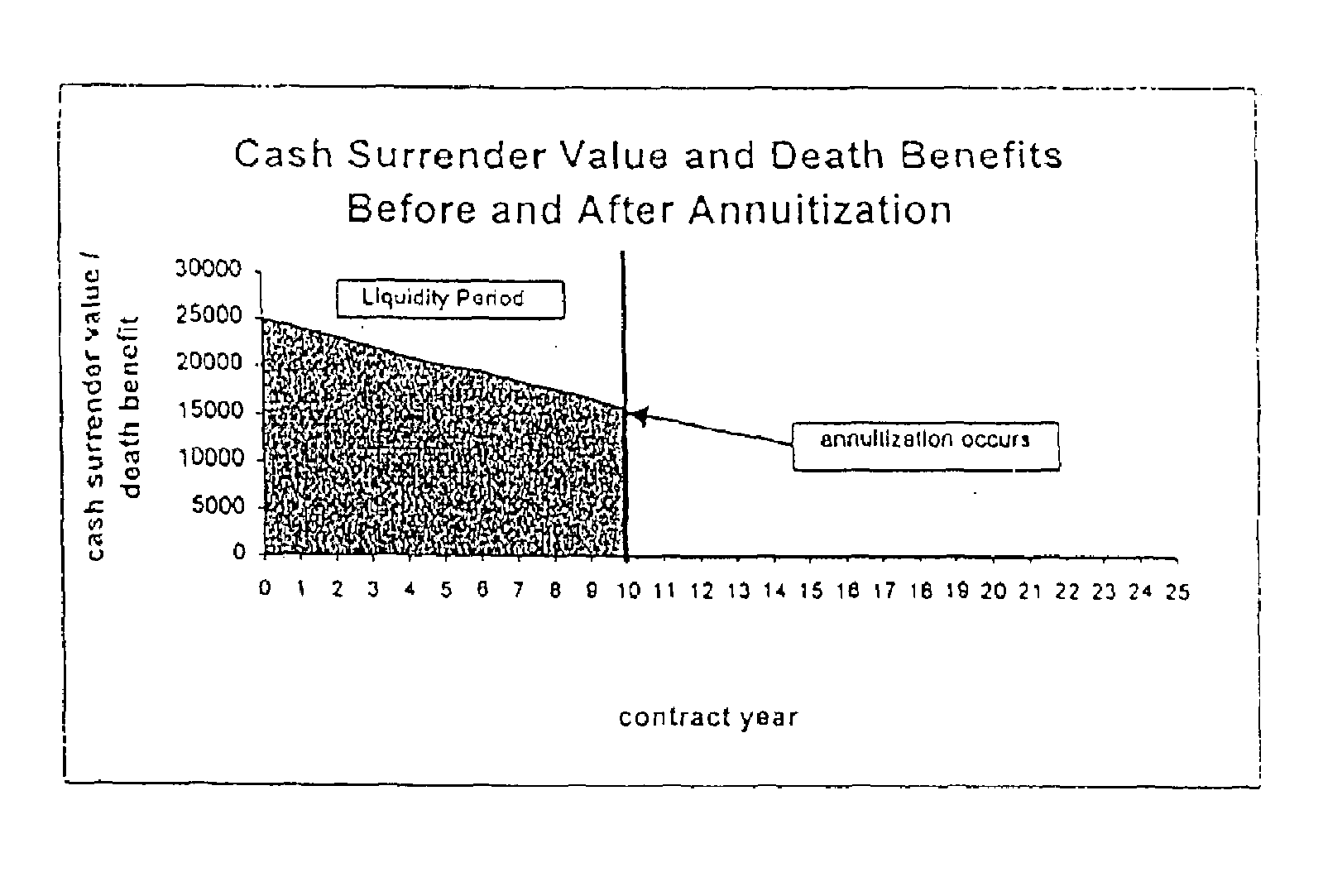

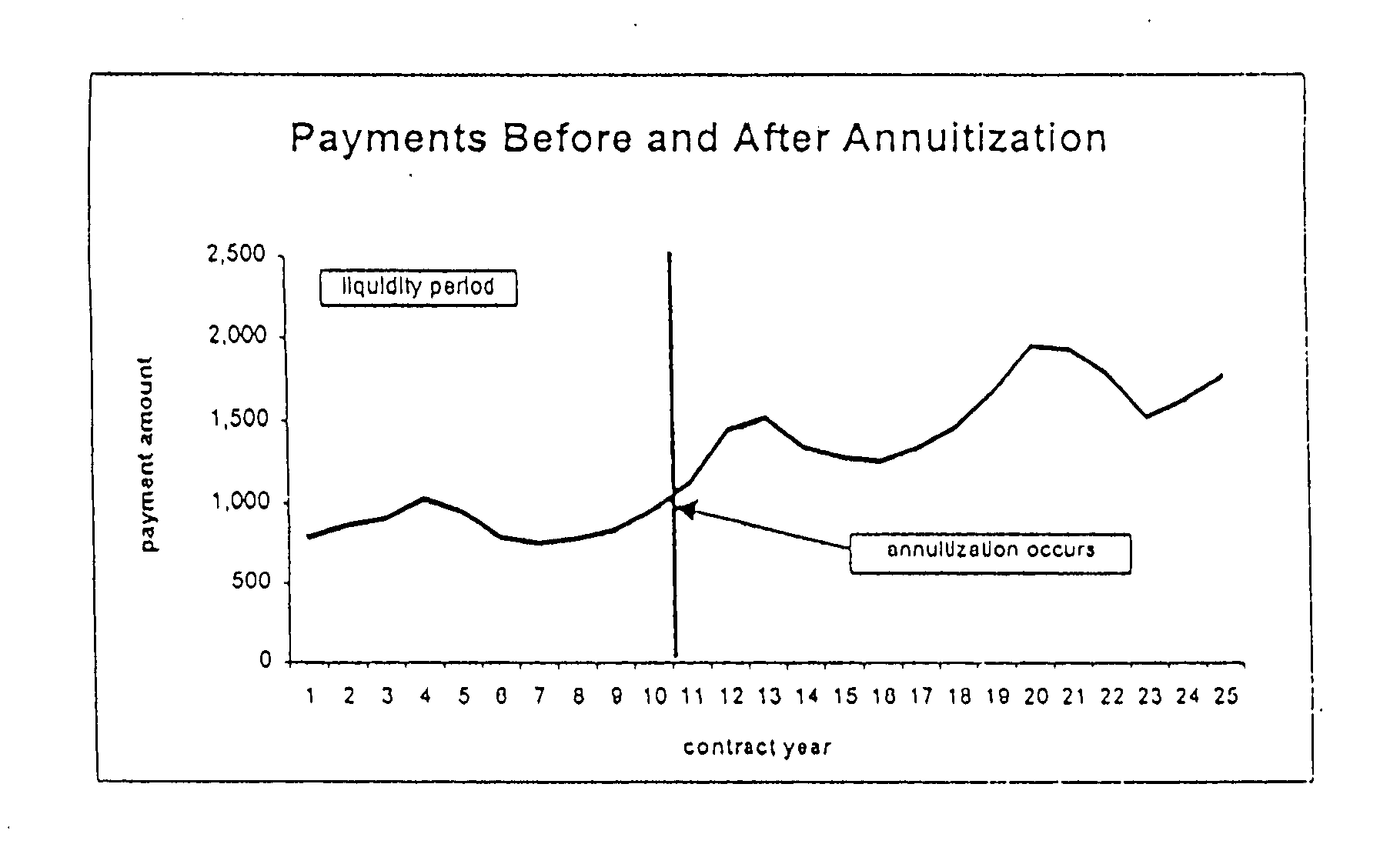

Method and apparatus for providing retirement income benefits

A computerized method of administering a benefit plan providing systematic withdrawal payments during a liquidity period and annuity payments when the systematic withdrawal payments cease. The method includes steps of storing data relating to the plan, and performing a sequence of steps during the liquidity period to determine an account value, and initial and current benefit payments. The method further includes the steps of determining the account value to be annuitized at the end of the liquidity period, and determining and paying initial and current annuity payments during the annuity period. The method may be used when the benefit plan is a straight life annuity benefit plan, or a life annuity benefit plan having either a death benefit, a surrender benefit, or both.

Owner:LINCOLN NAT LIFE INSURANCE

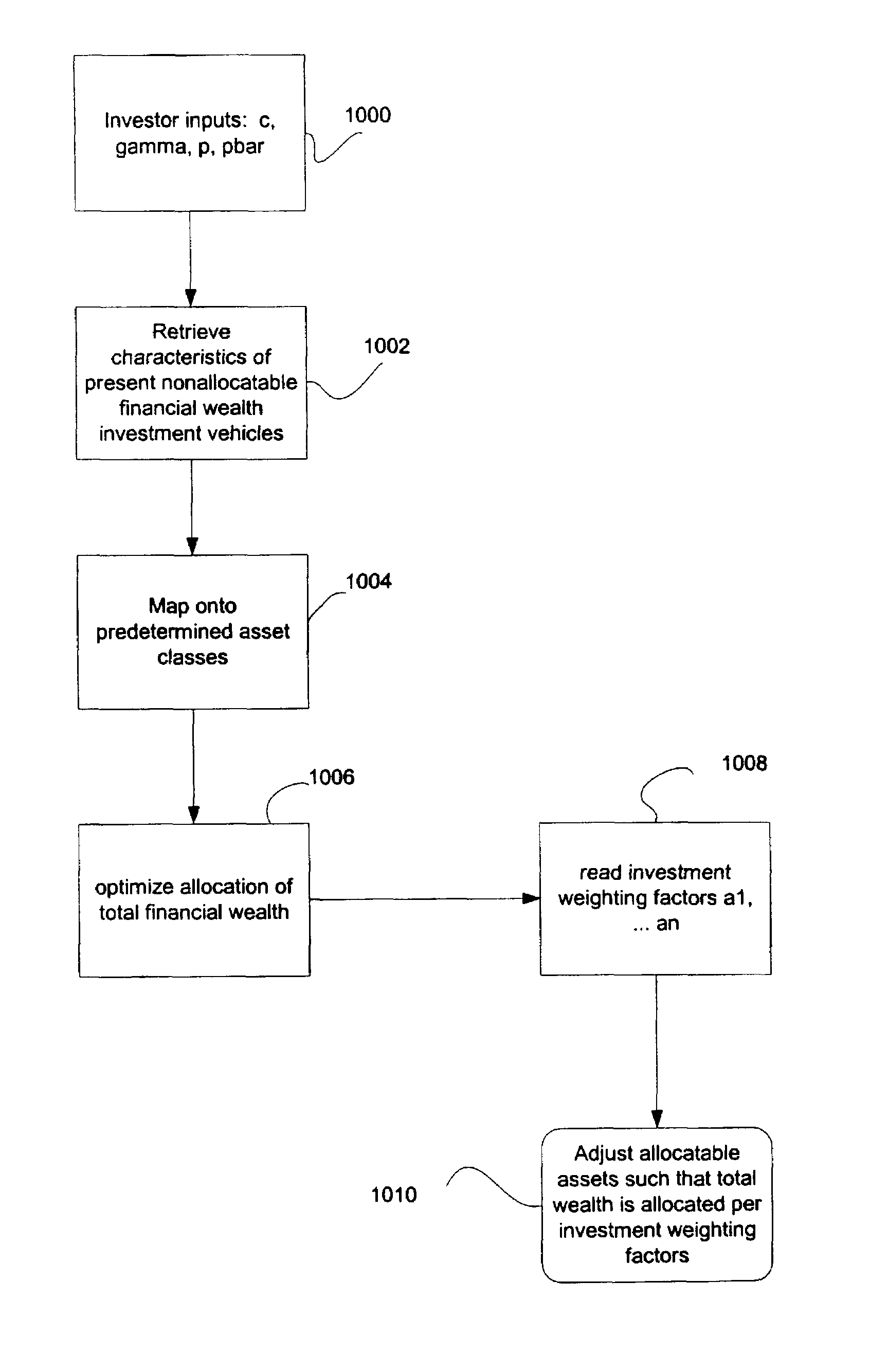

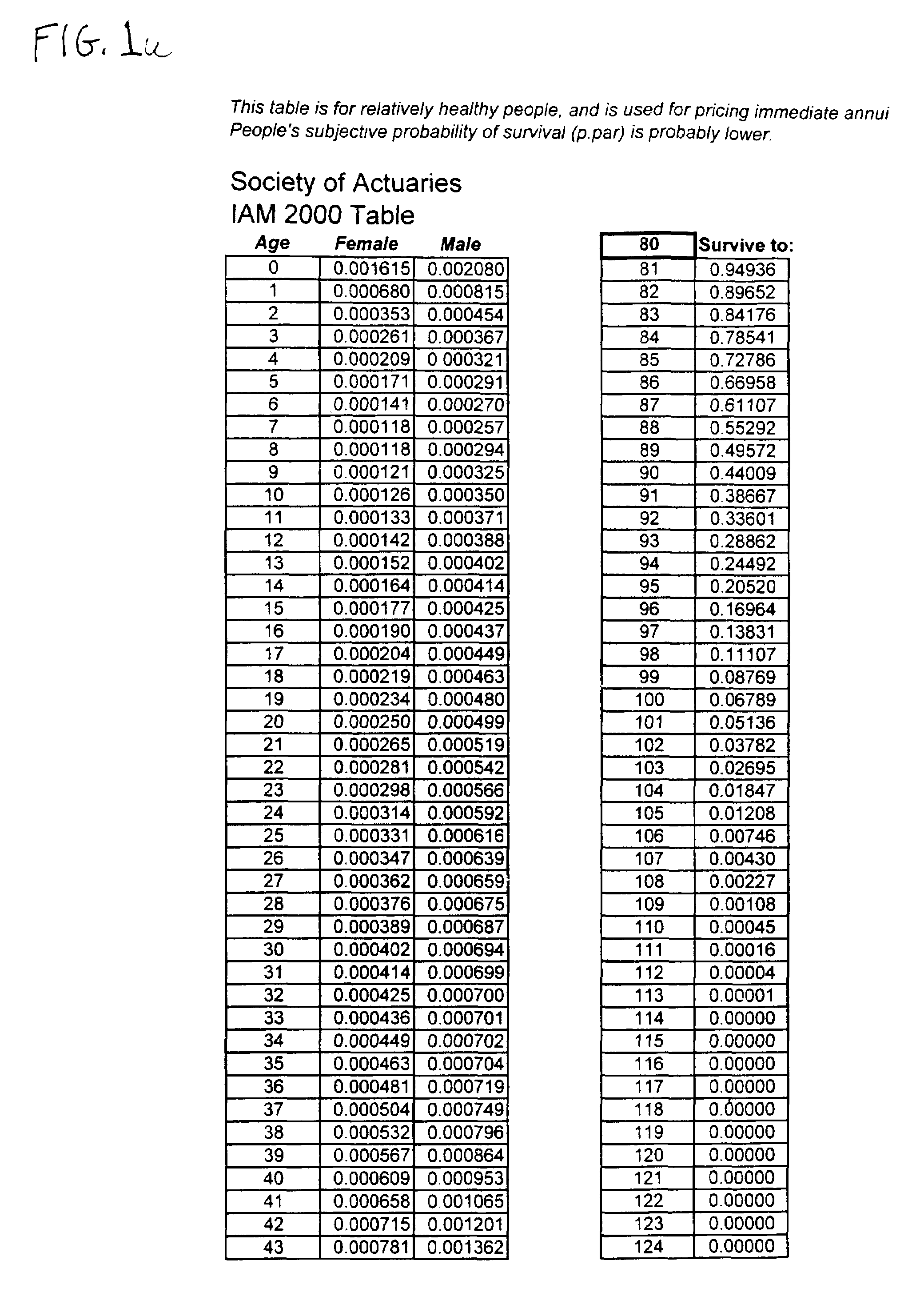

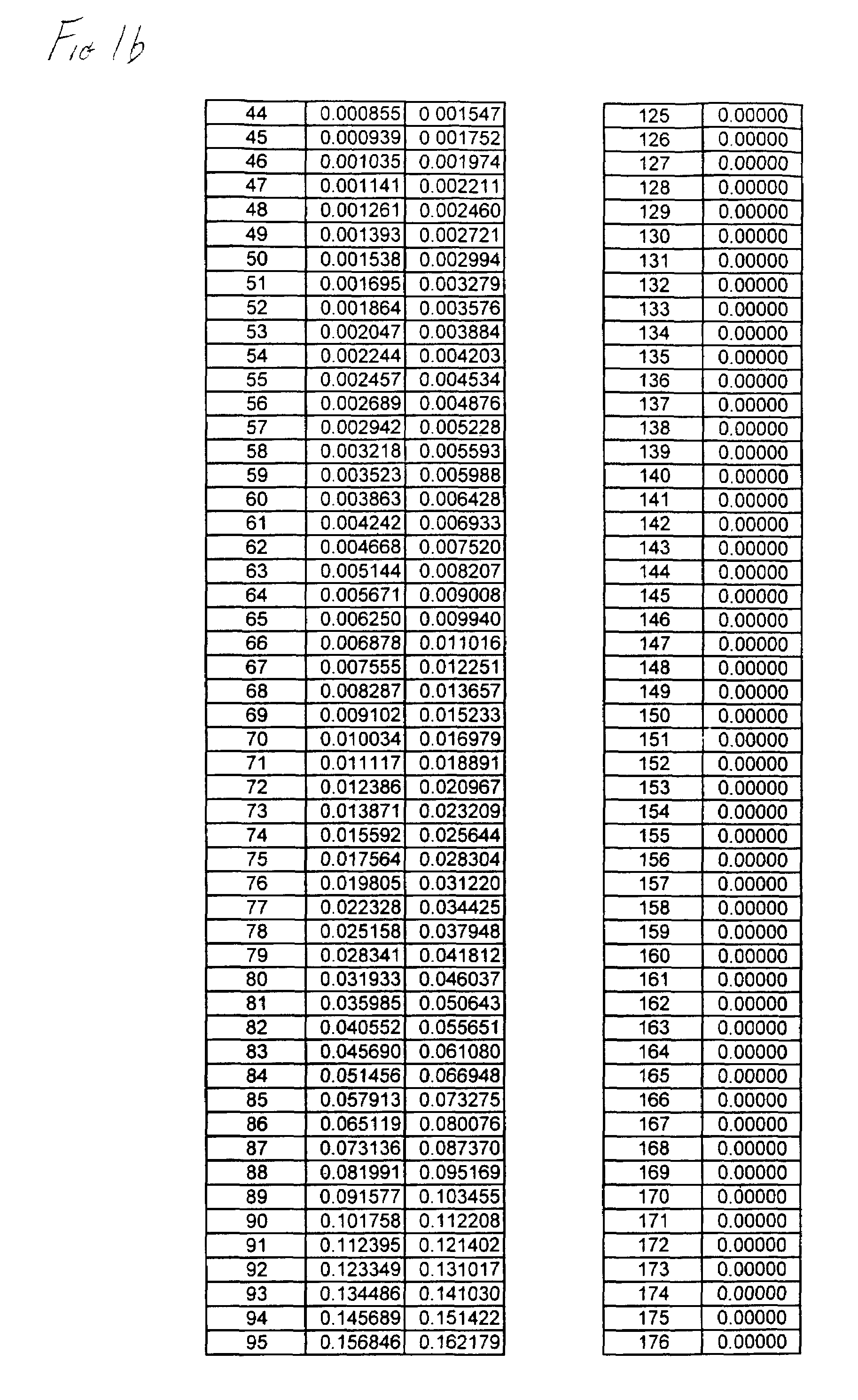

Optimal asset allocation during retirement in the presence of fixed and variable immediate life annuities (payout annuities)

A method, system and medium for optimally allocating investment assets for a given investor within and between annuitized assets and non-annuitized assets retrieves an investor's utility of consumption, utility of bequest, objective and subjective probabilities of survival and expected rates of return from each of a plurality of annuity and nonannuity assets having varying degrees of risk and return. Based on these inputs, an objective utility function is maximized by adjusting the asset allocation weights. The optimal asset allocation weights may be used to allocate the assets of the investor's portfolio among predetermined investment vehicles or as an analytical tool by portfolio managers.

Owner:IBBOTSON ASSOCS

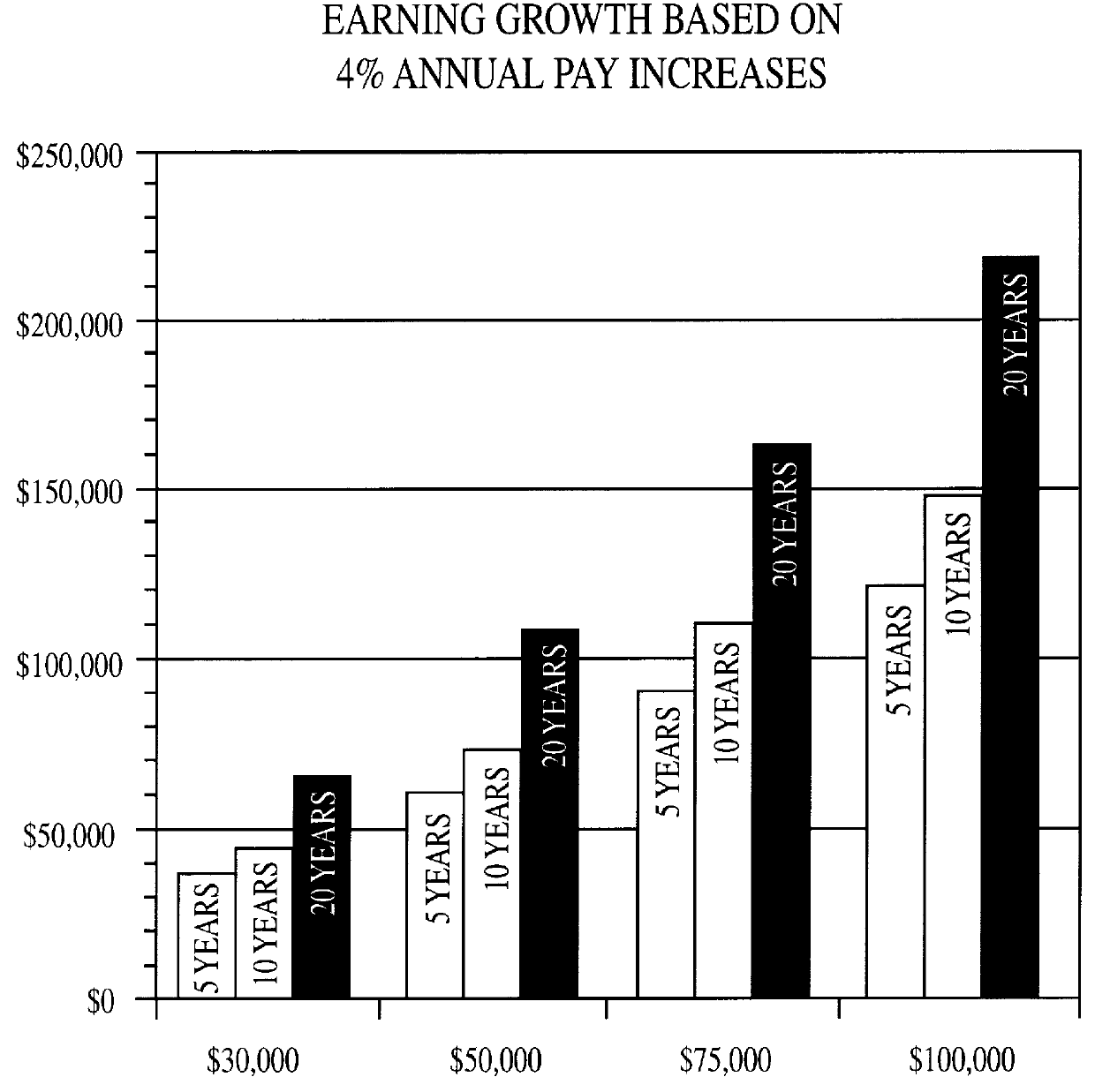

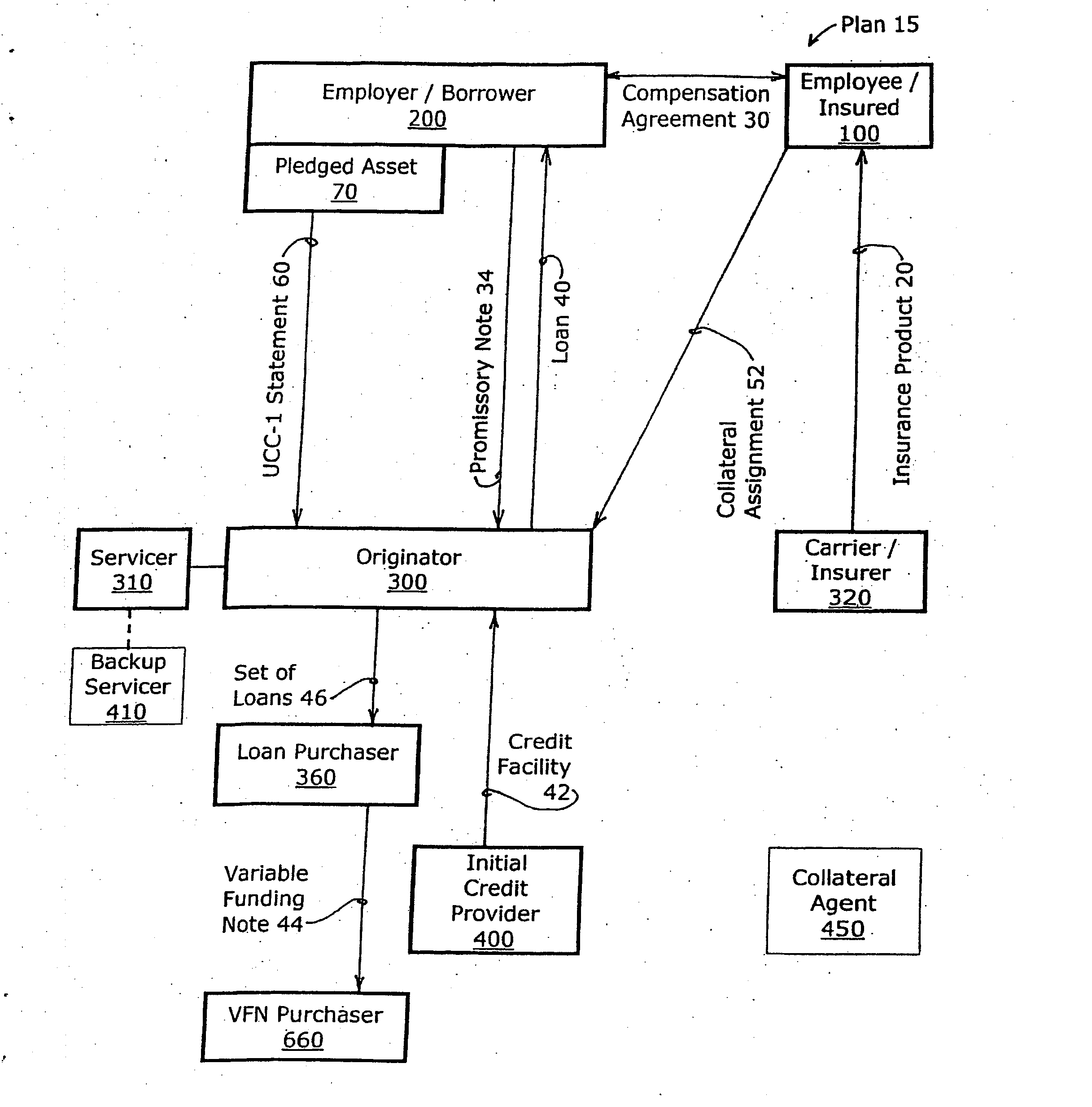

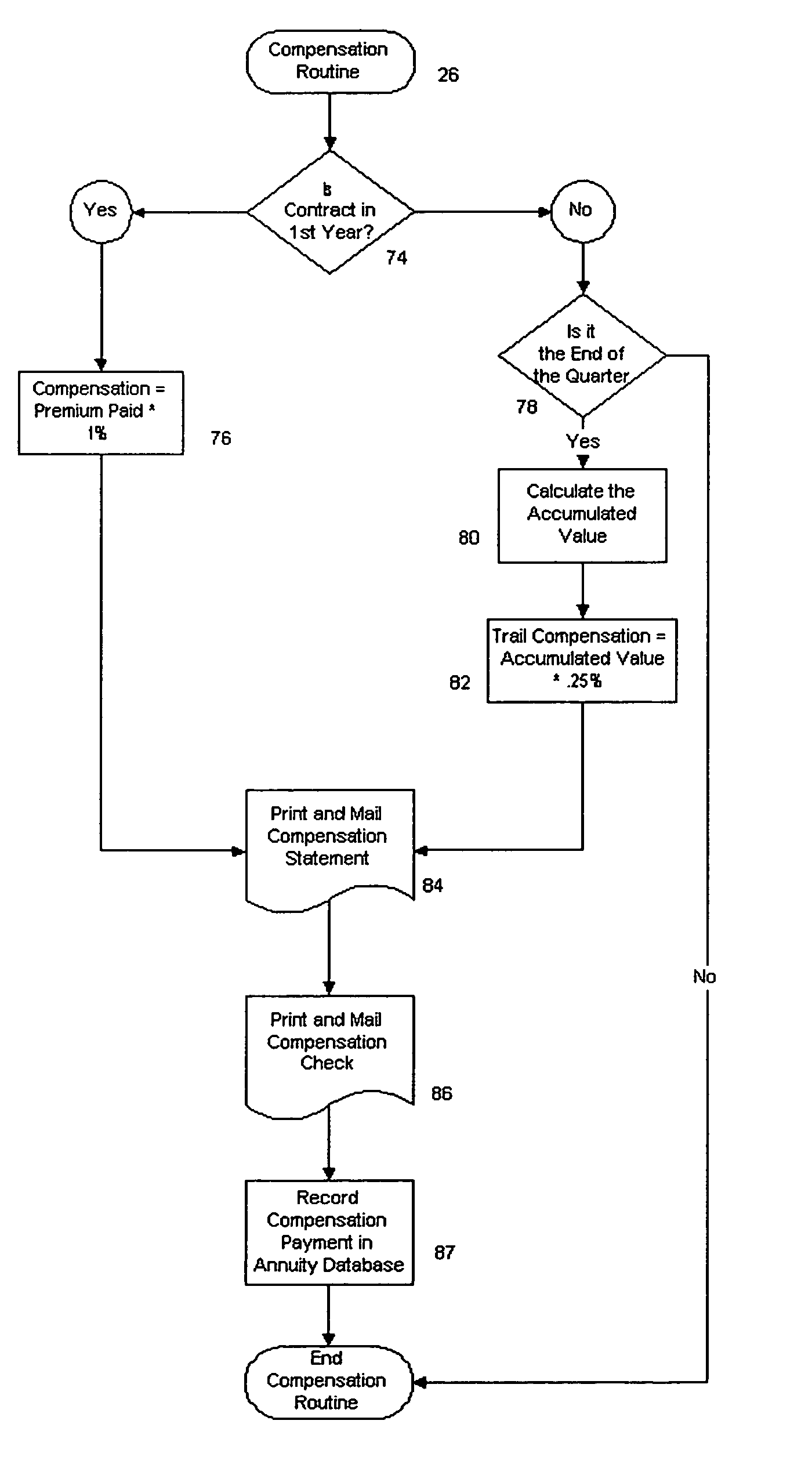

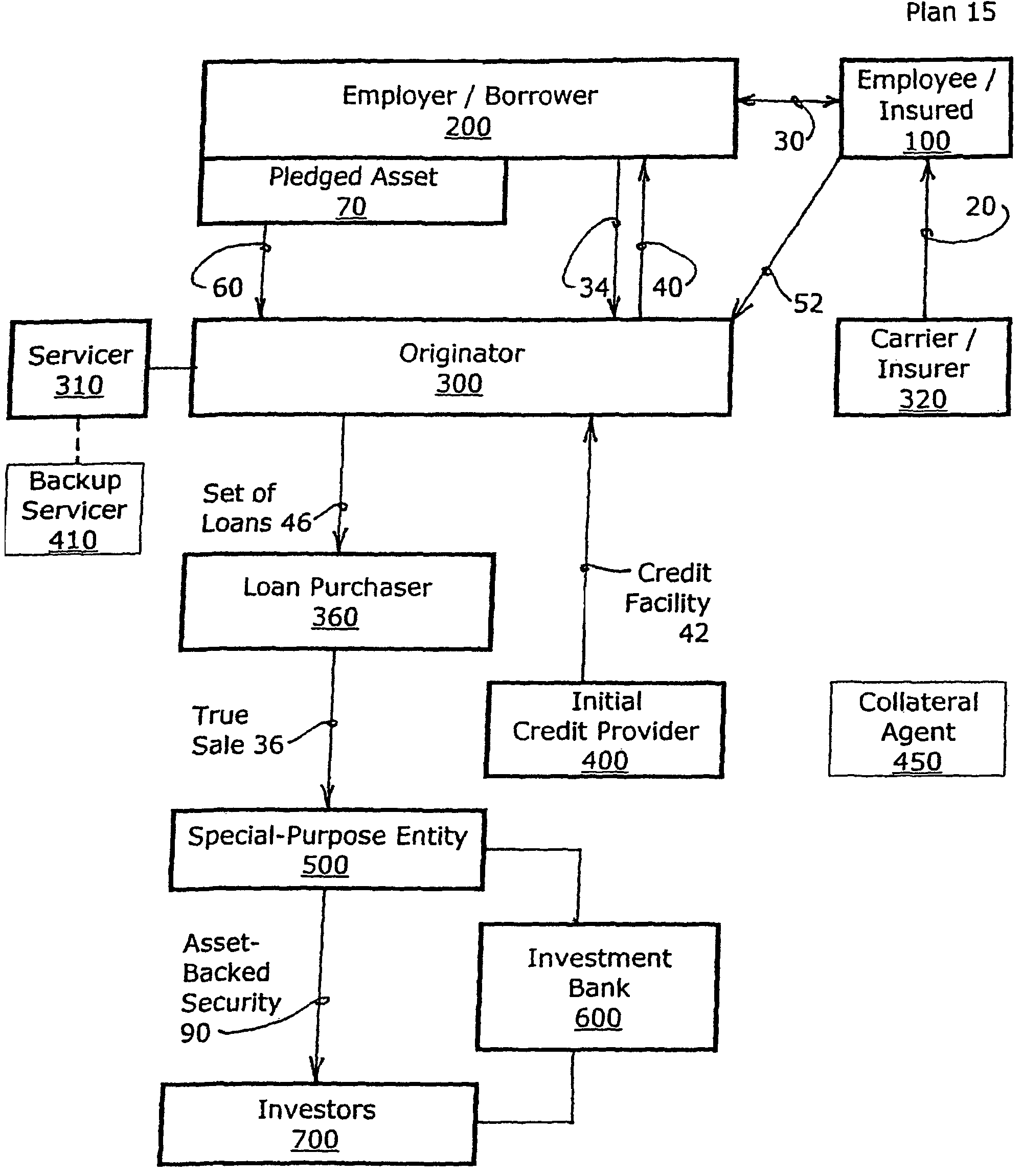

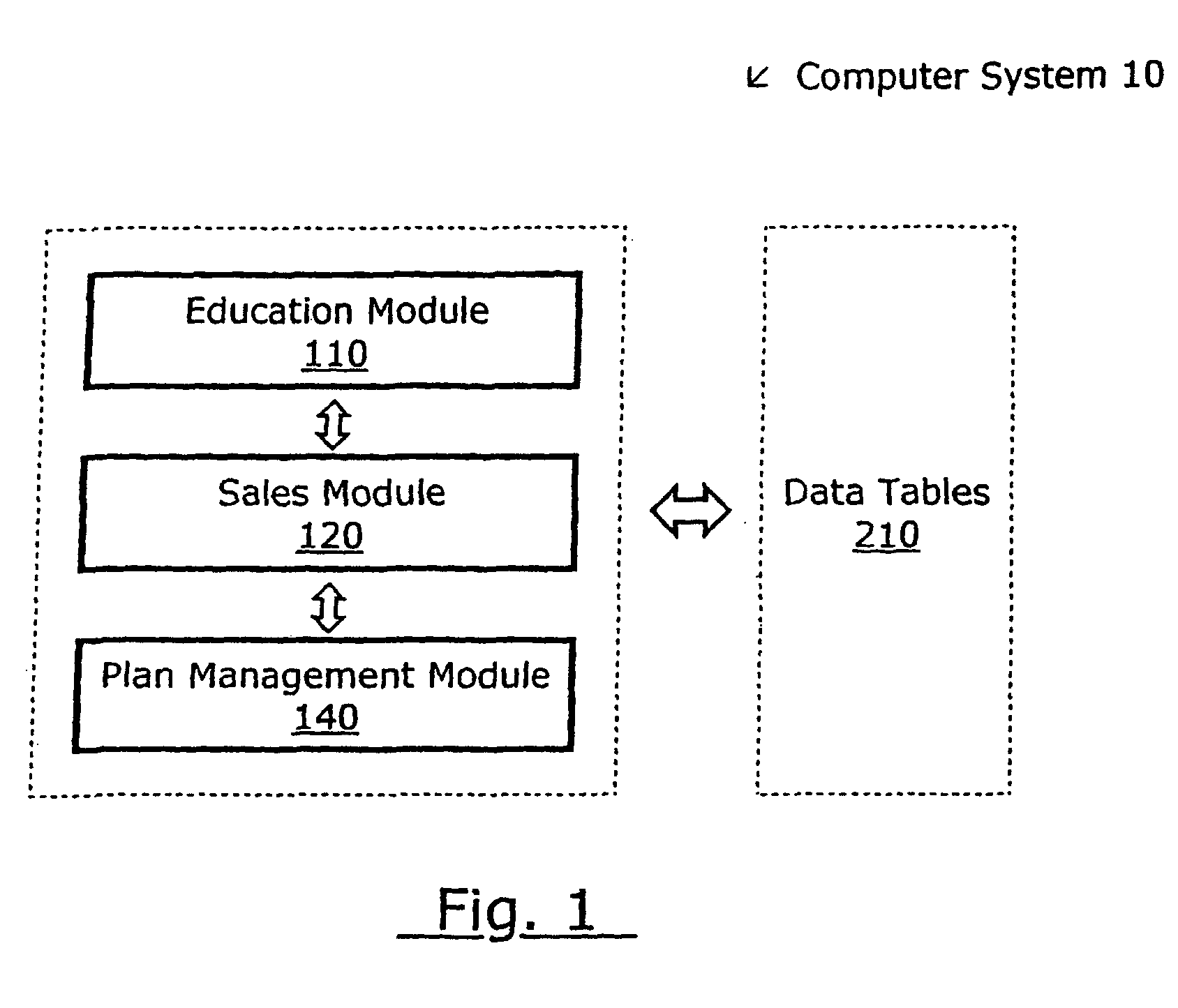

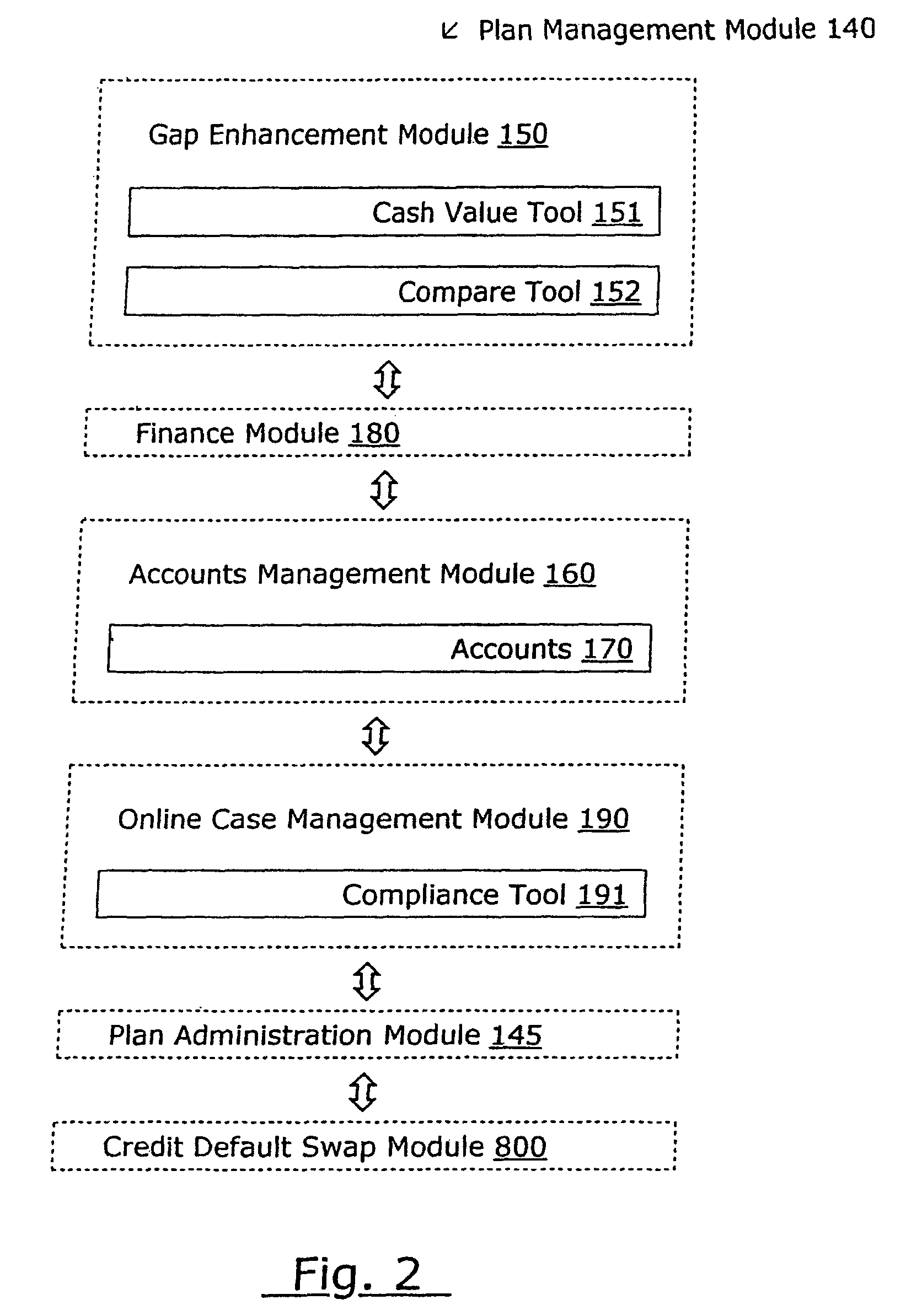

Method of compensating an employee

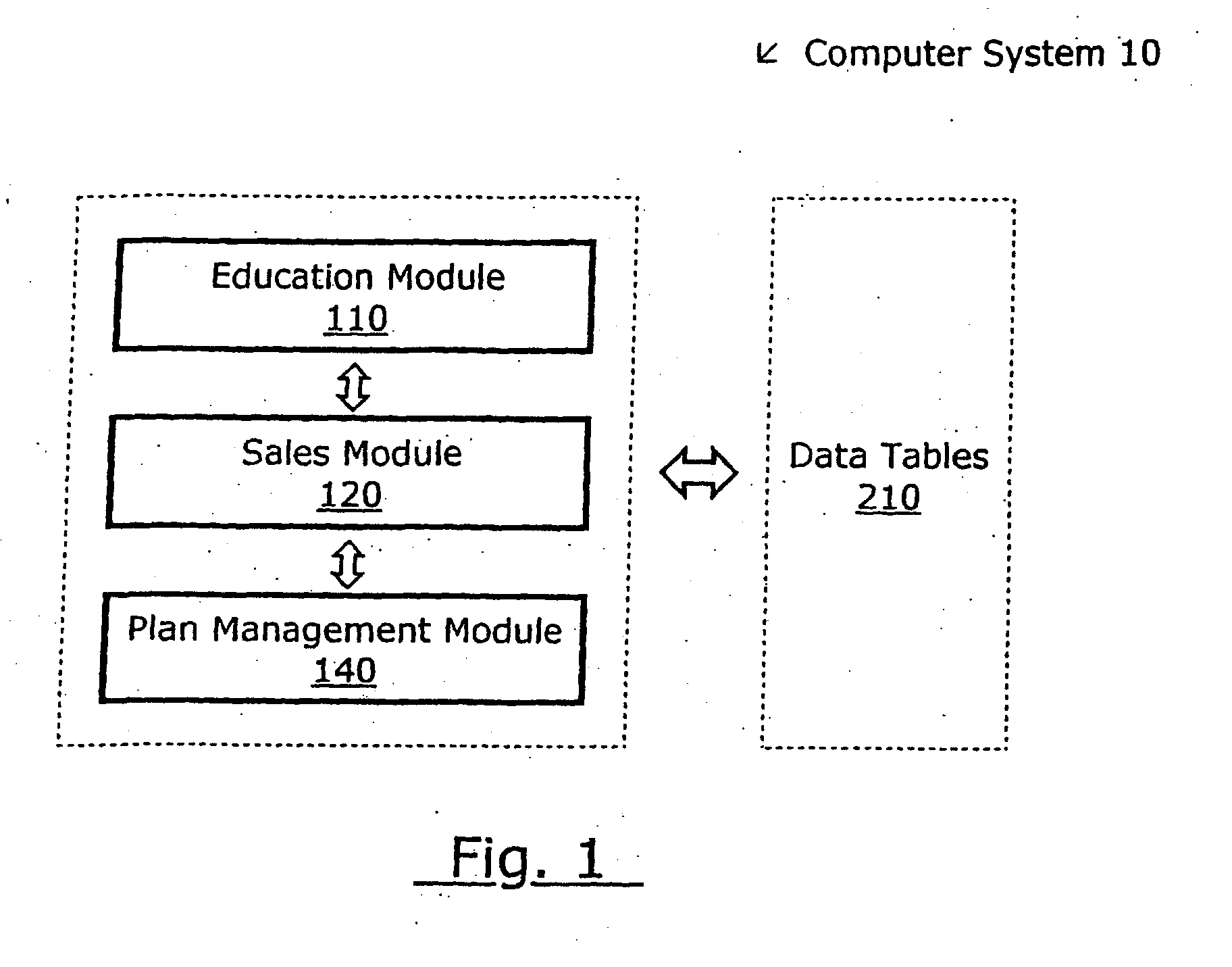

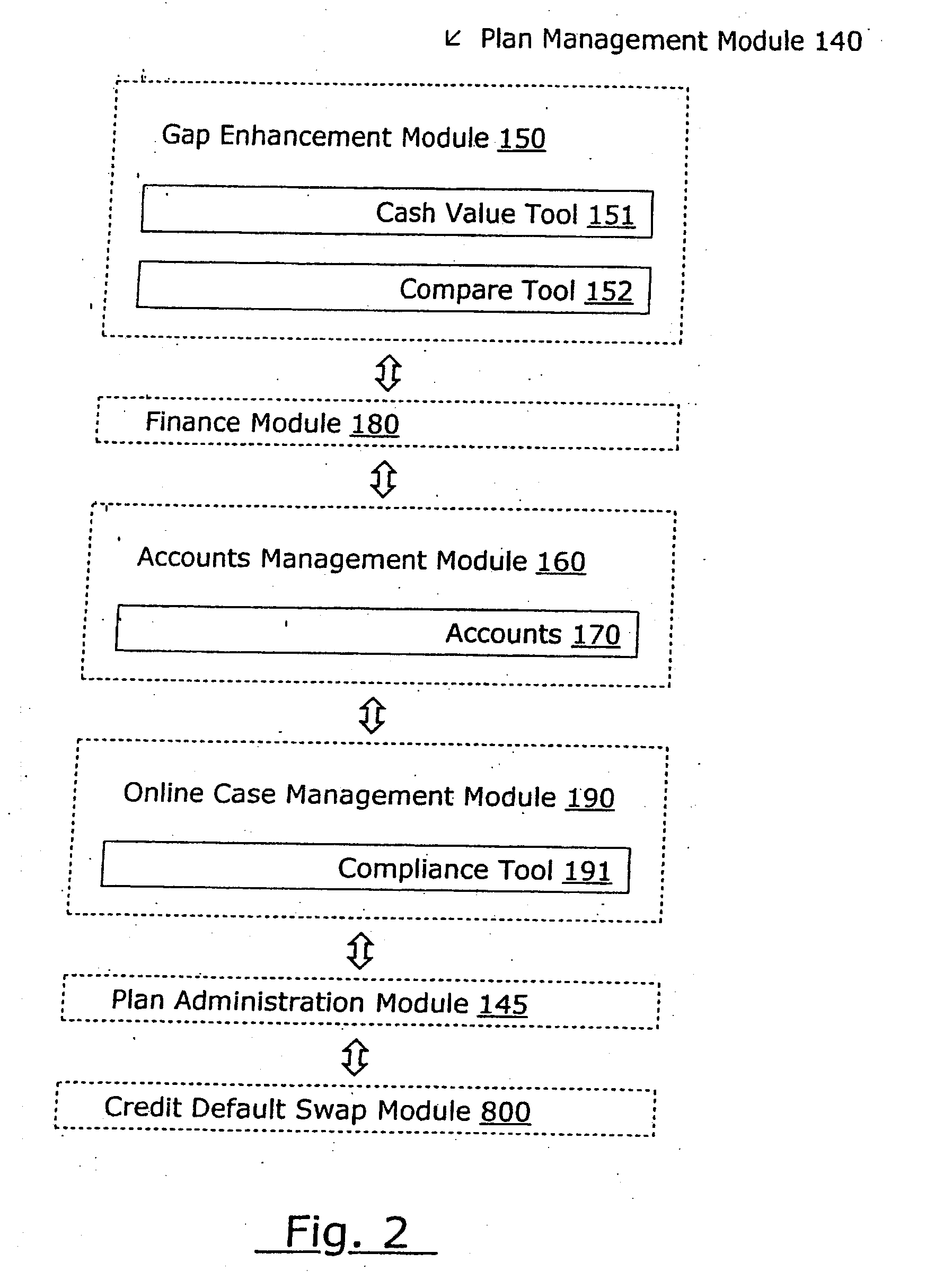

A computer system for monitoring and enhancing the collateral security underlying a set of loans is provided, including a system for calculating the unsecured value of the set at any time and for initiating additional collateral enhancement instruments when the unsecured value exceeds a certain limit. The system may include a variety of modules in communication with a relational database for storing data about the loans and system elements. The computer system may also be configured to allocate, manage, and execute the waterfall or cascade of funds between and among the various participants in a financial plan. The invention also includes a structured finance plan and related methods for enhancing the collateral security of a loan obtained for a life insurance or annuity product, and a system and method for managing a portfolio of such loans in order to obtain favorable financing and to facilitate securitization.

Owner:ENTAIRE GLOBAL INTPROP

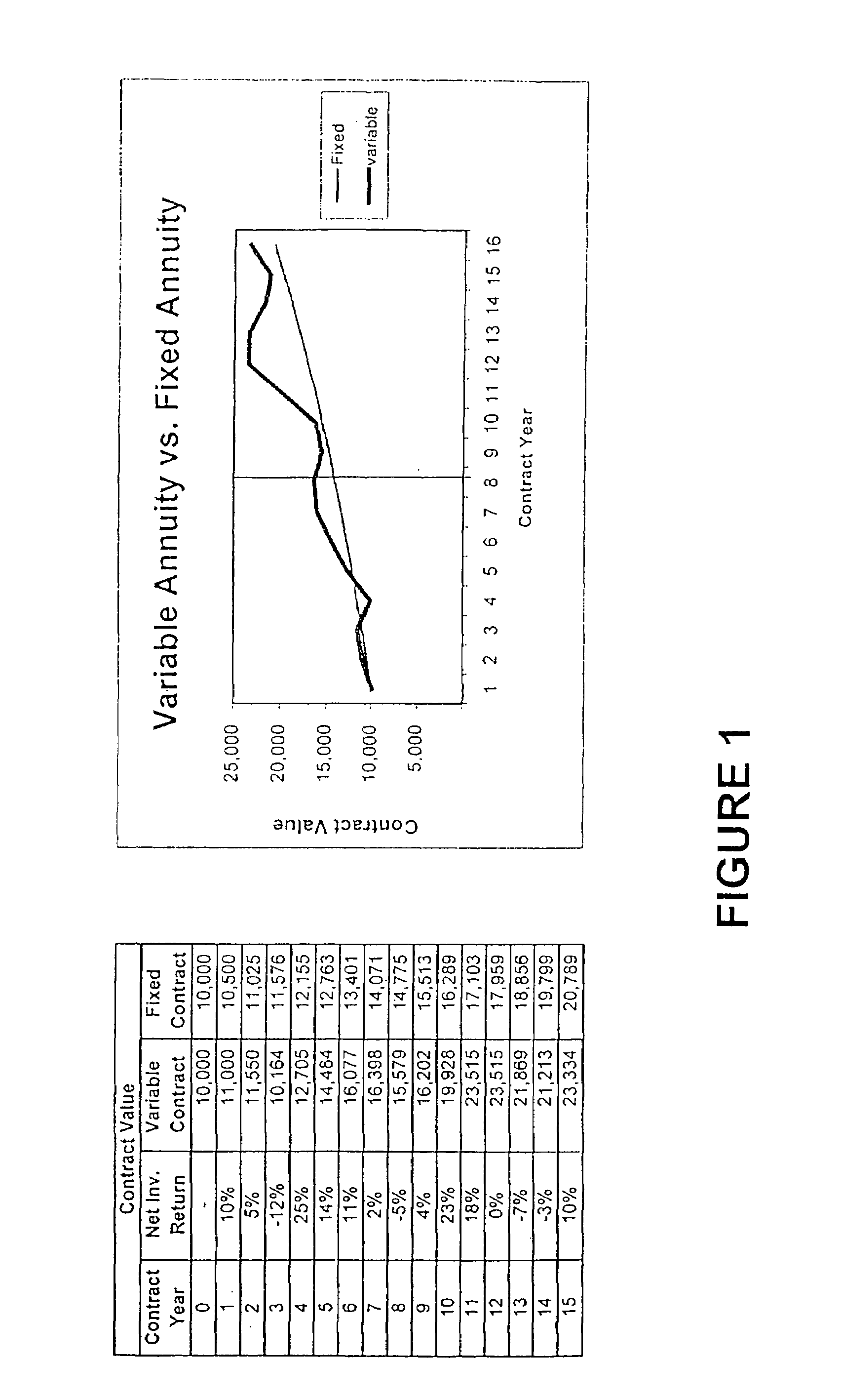

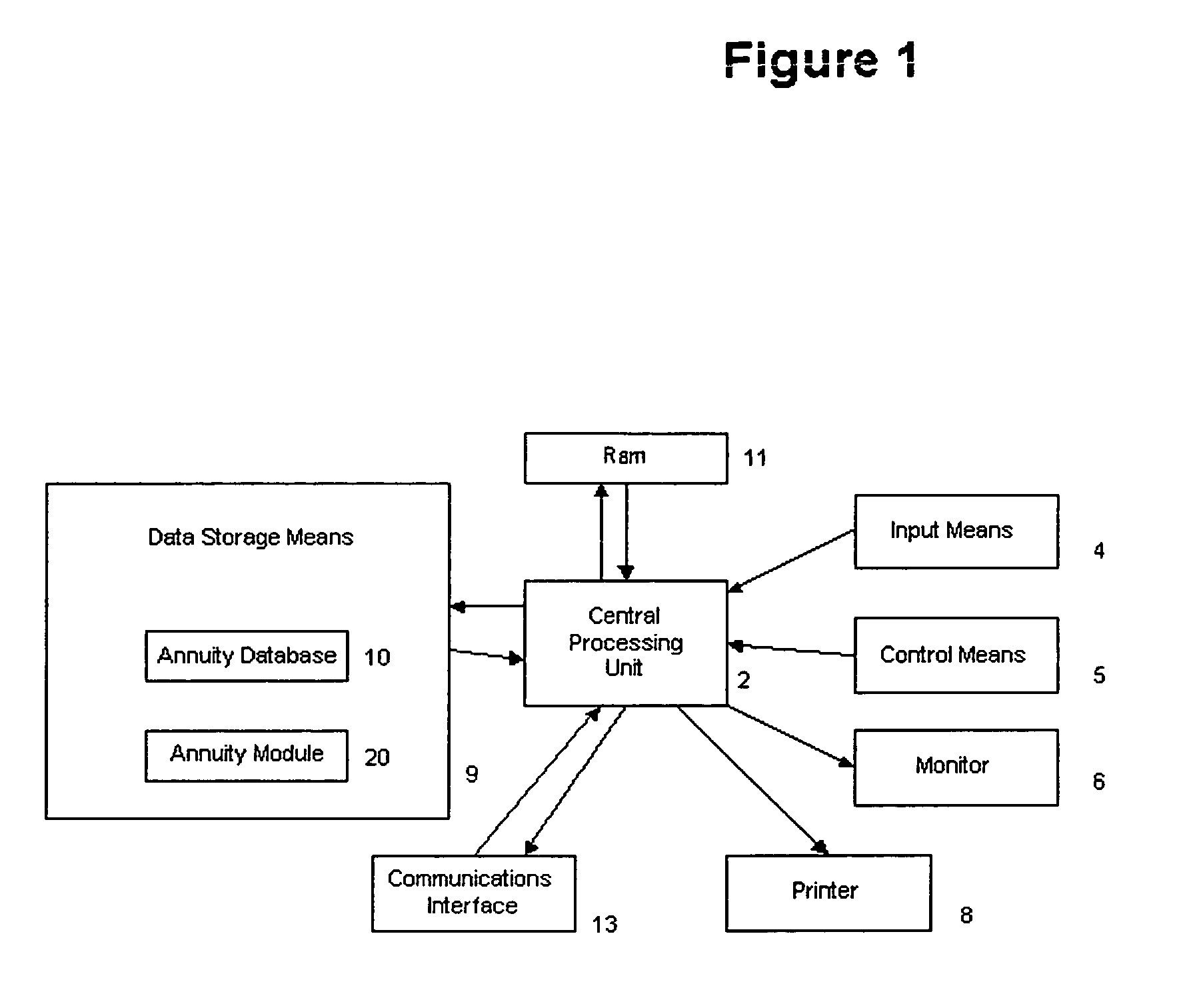

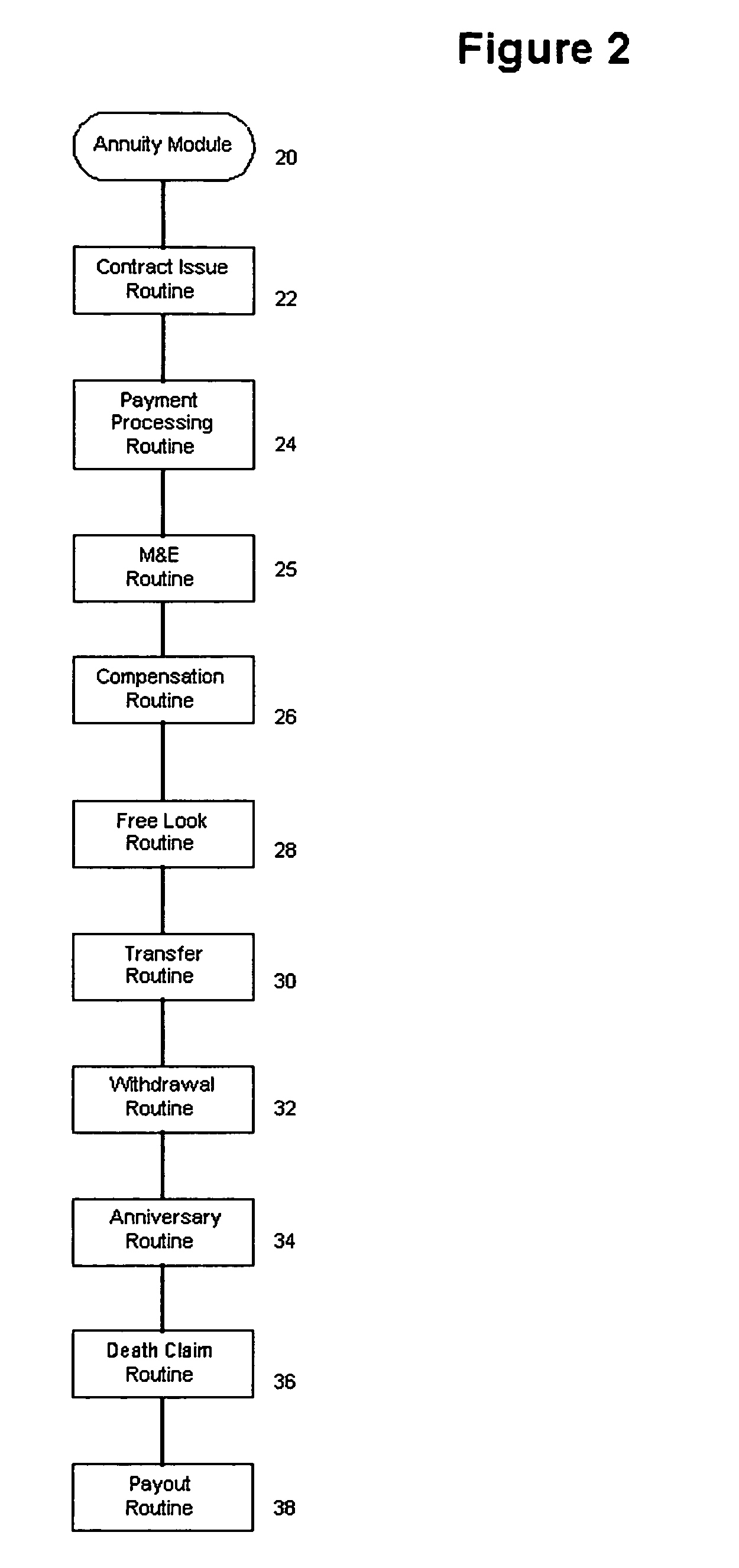

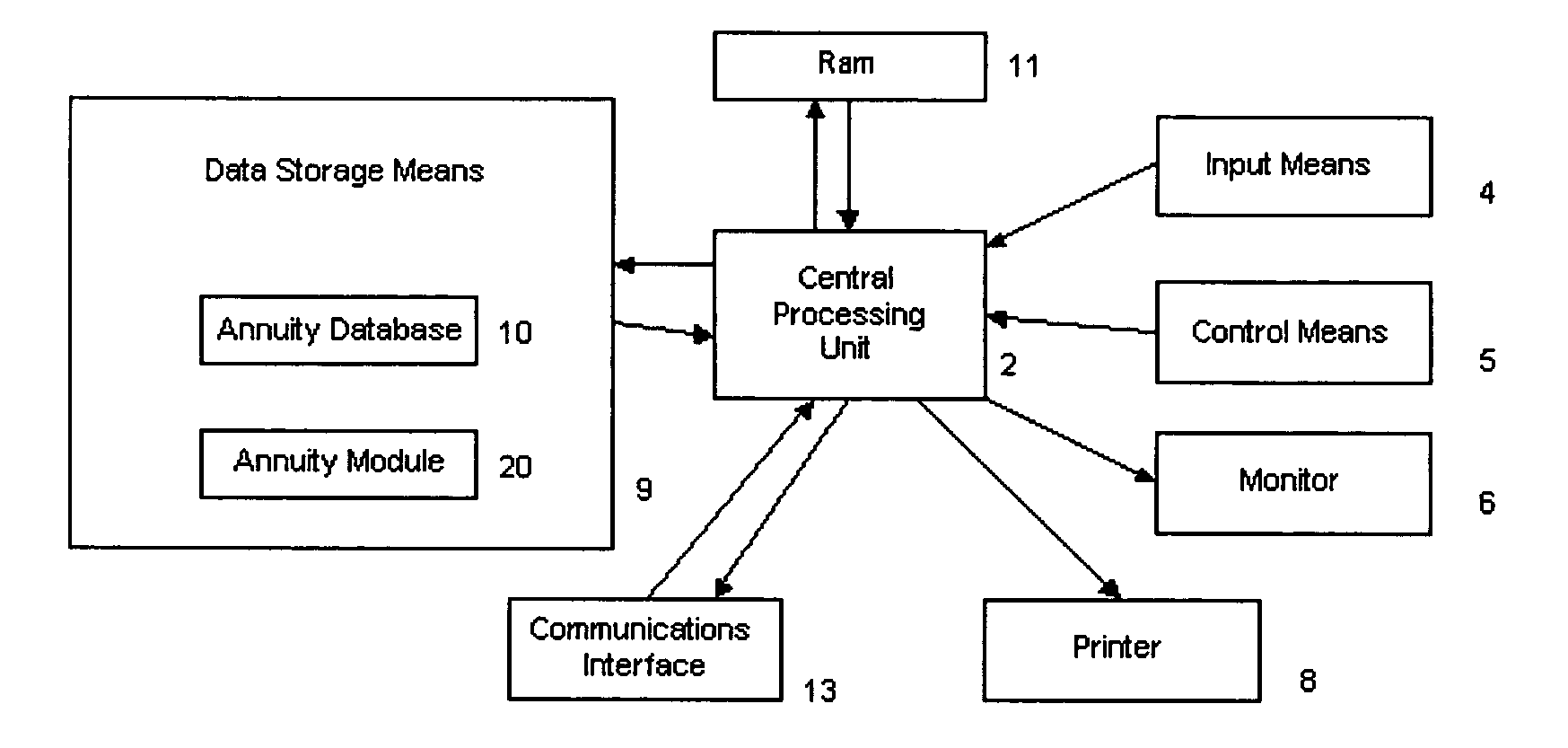

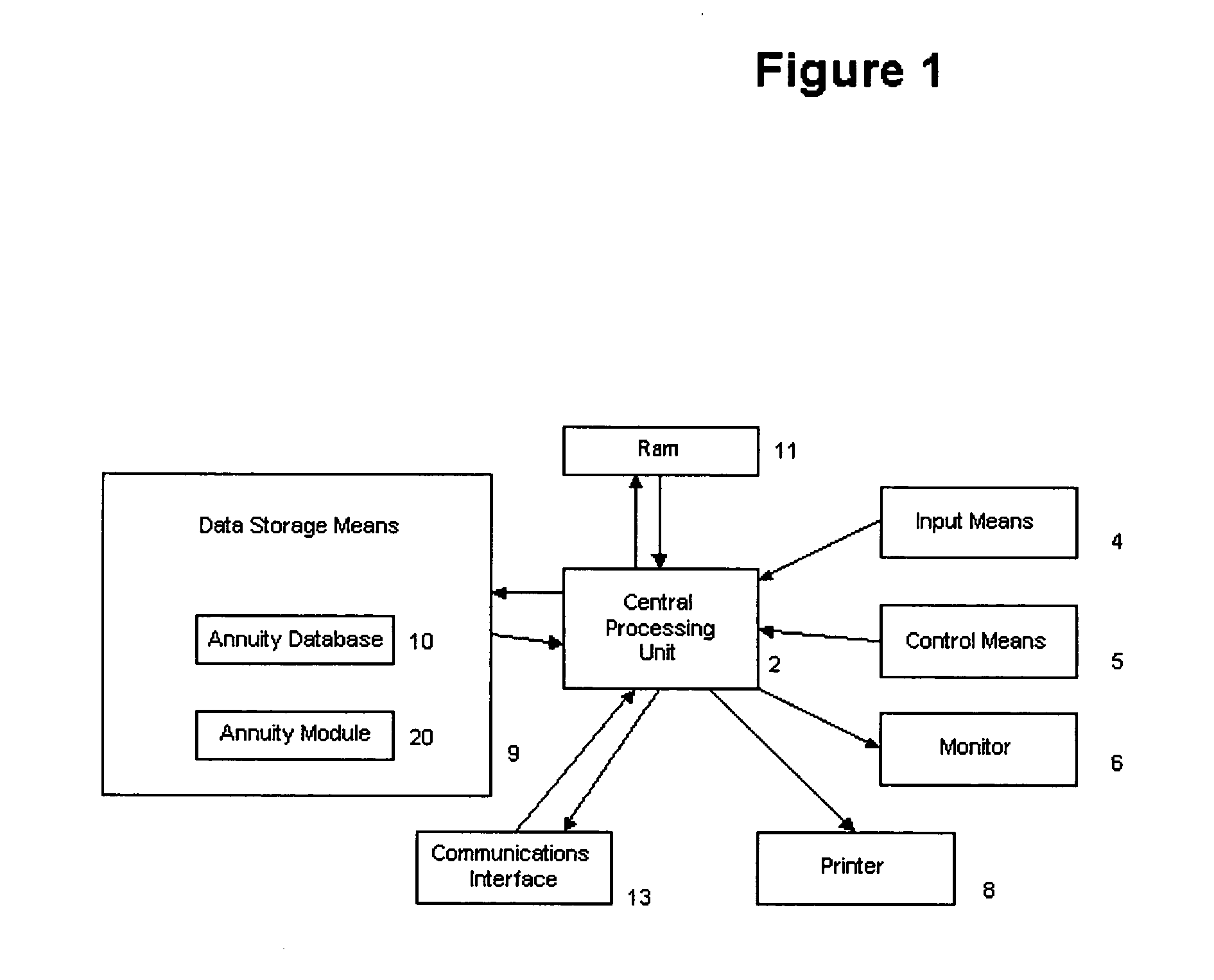

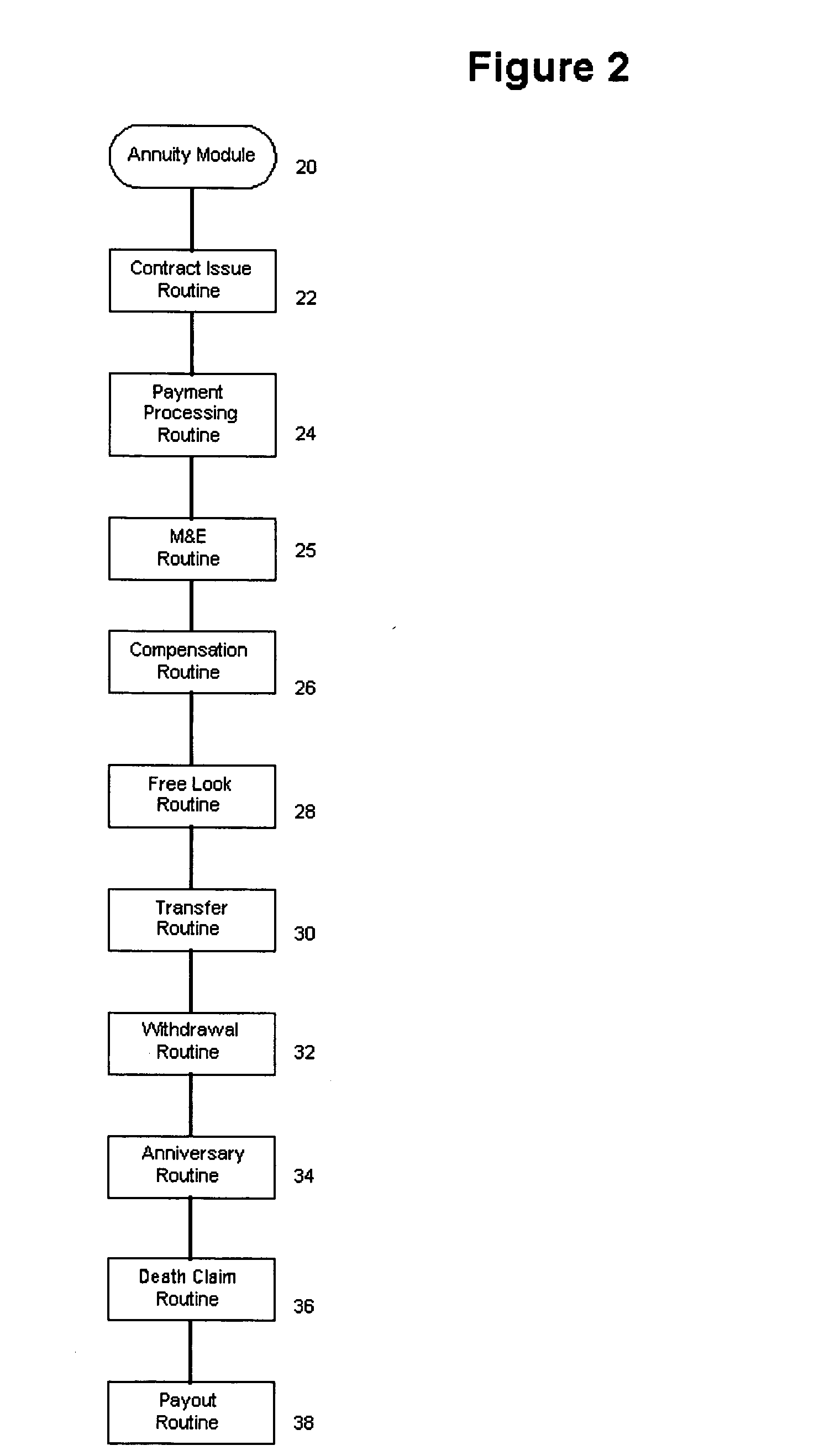

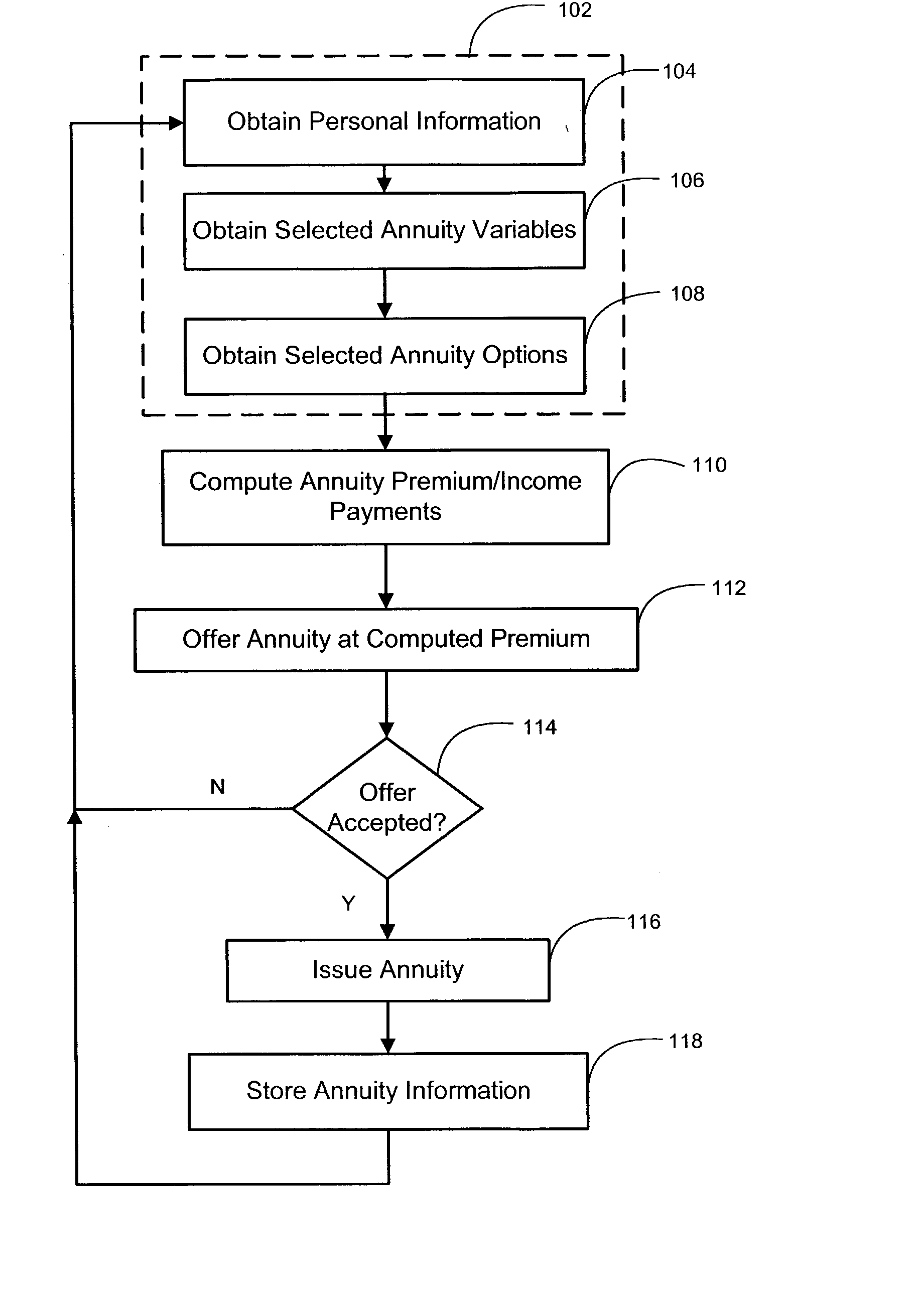

System for and method of variable annuity contract administration

A system for and method of variable annuity contract administration is provided. Each variable annuity contract includes a bonus investment credit percentage, withdrawal charge percentages less than or equal to the bonus investment credit percentage in all contract years, and level asset-based compensation to distributors. In accordance with the invention, data relating to variable annuity contracts are stored in a memory means. A processing means is configured to read and manipulate the stored data to administer the variable annuity contracts from issuance to payout.

Owner:GUARDIAN LIFE INSURANCE COMPANY OF AMERICA

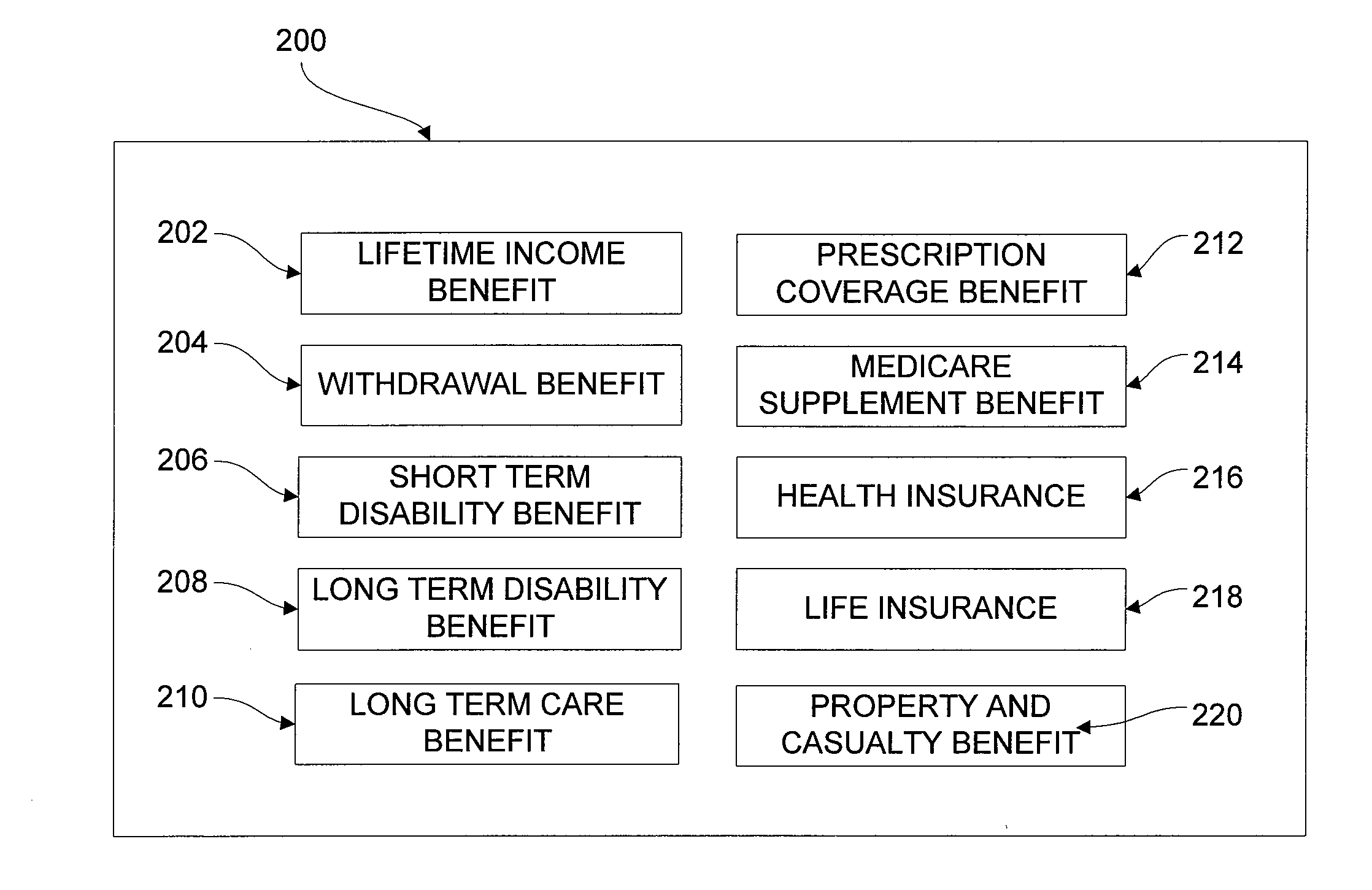

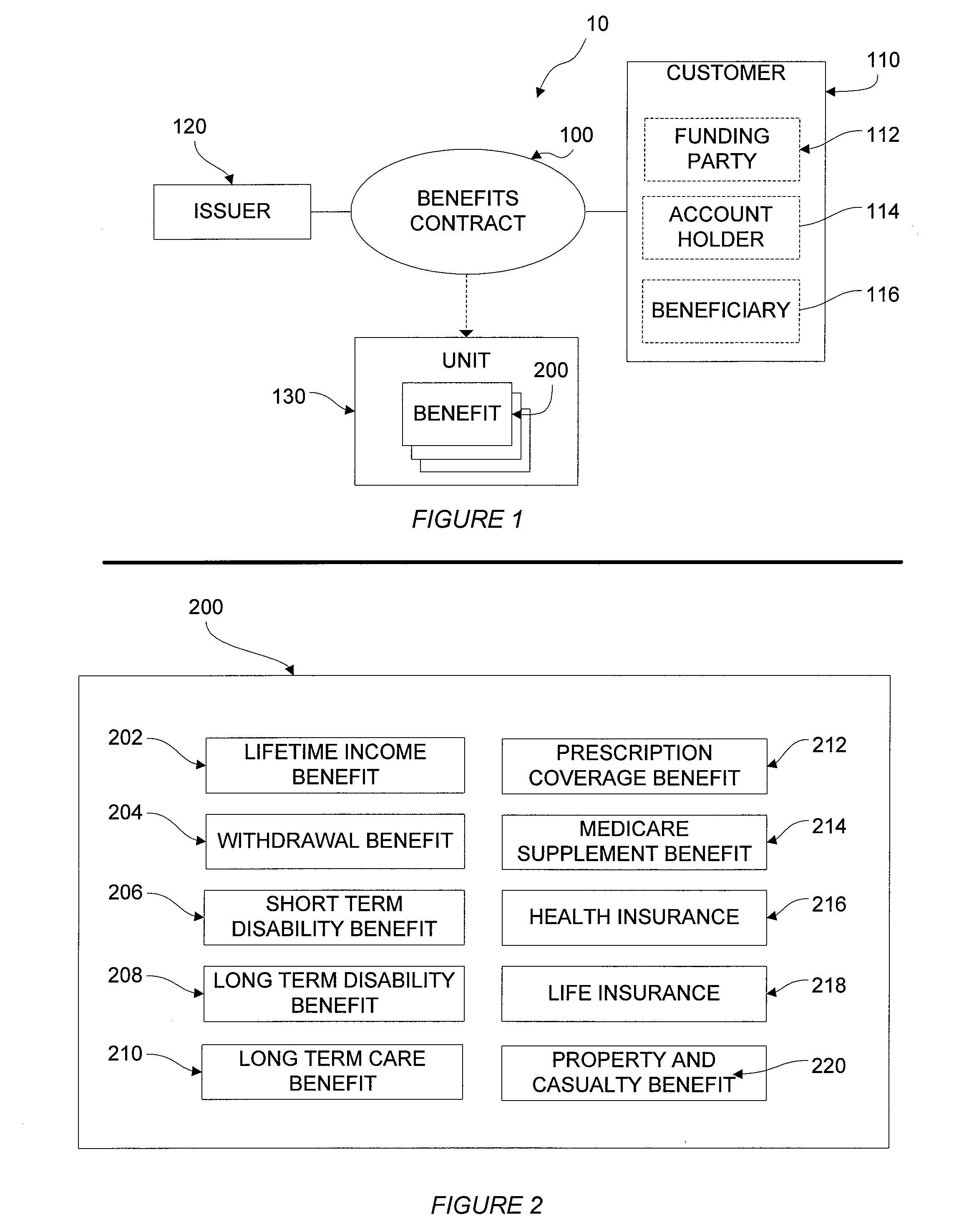

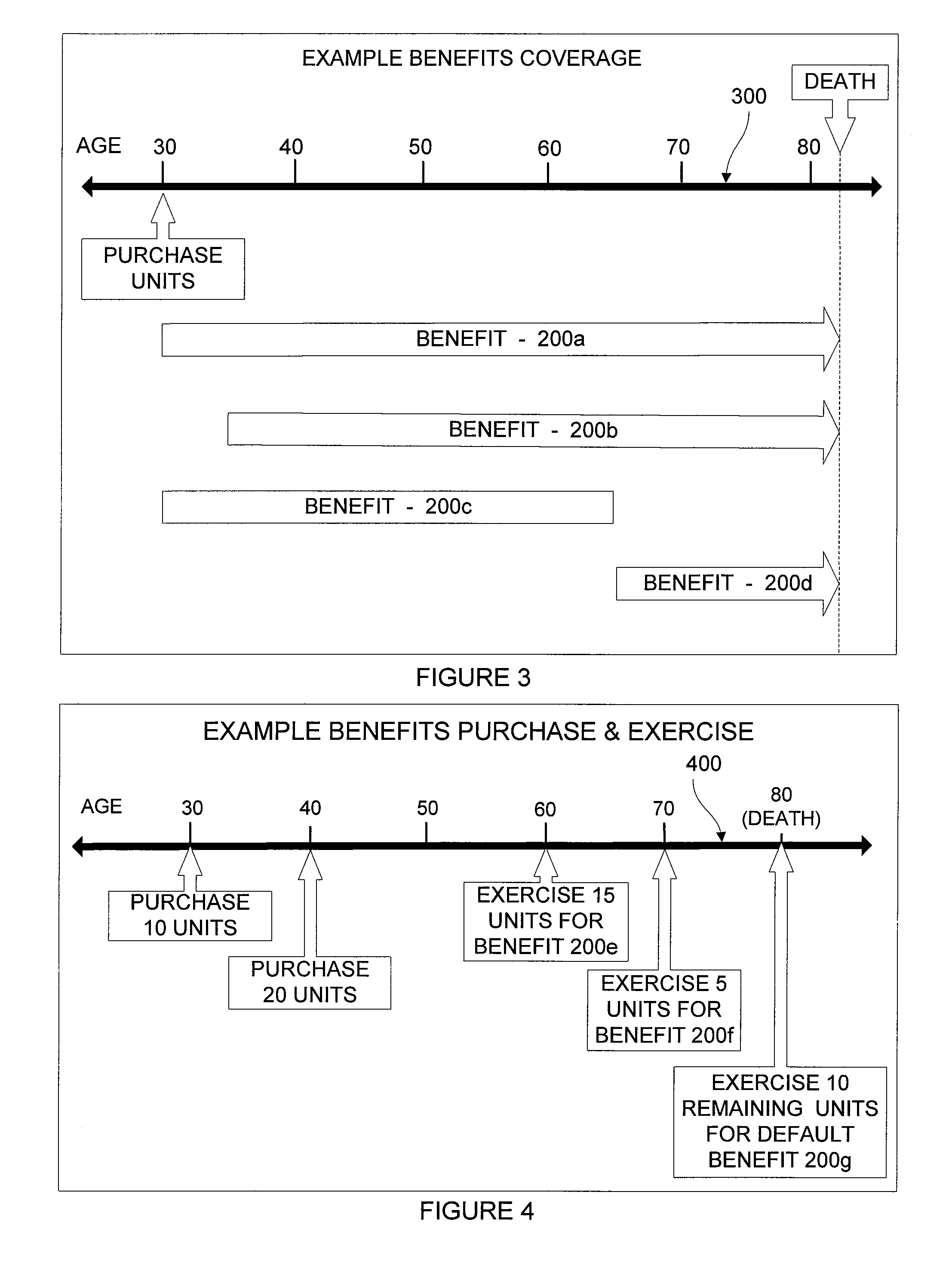

Benefits Contract Providing a Bundle of Benefits

ActiveUS20070021986A1Simplify decision making processLow costFinanceCommerceInsurance lifeLong-term care insurance

According to one embodiment of the invention, a benefits contract includes an agreement to provide a plurality of benefits for at least one person. The agreement provides for an account including a plurality of units. Each unit is associated with multiple benefits. For example each unit may be associated with multiple benefits such as life insurance, health insurance, supplemental health insurance, long-term care insurance, short-term disability insurance, long-term disability insurance, prescription drug insurance, a plurality of income payments, a withdrawal benefit, an annuity, a property and casualty benefit, or other similar benefits. The agreement is such that a person associated with the benefits contract may choose to exercise a particular unit, or fraction thereof, to receive only one of the three or more benefits; and such that the benefits account (or plurality of units) may be purchased tax-free using funds from a tax-deferred retirement account.

Owner:PRUDENTIAL INSURANCE OF AMERICA

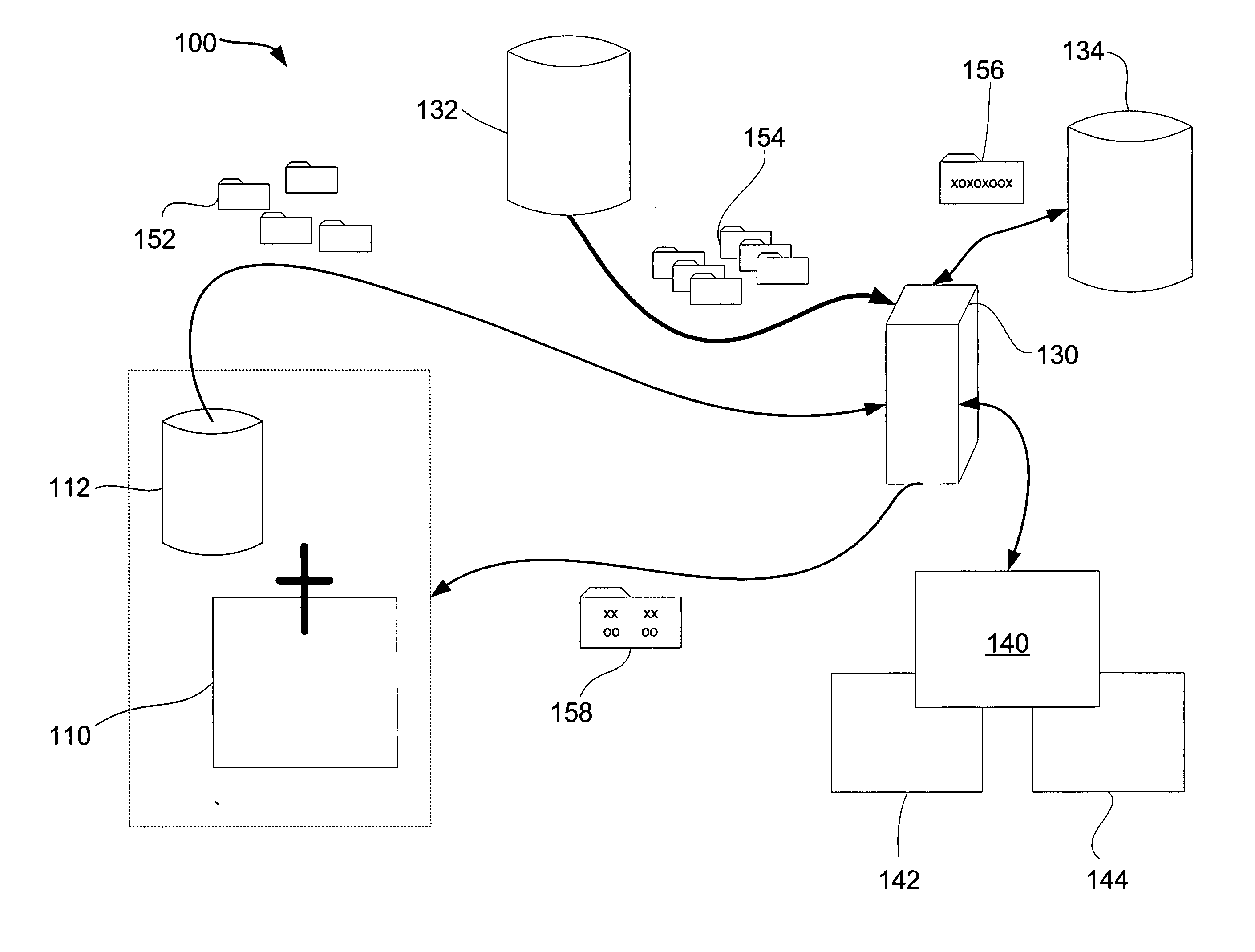

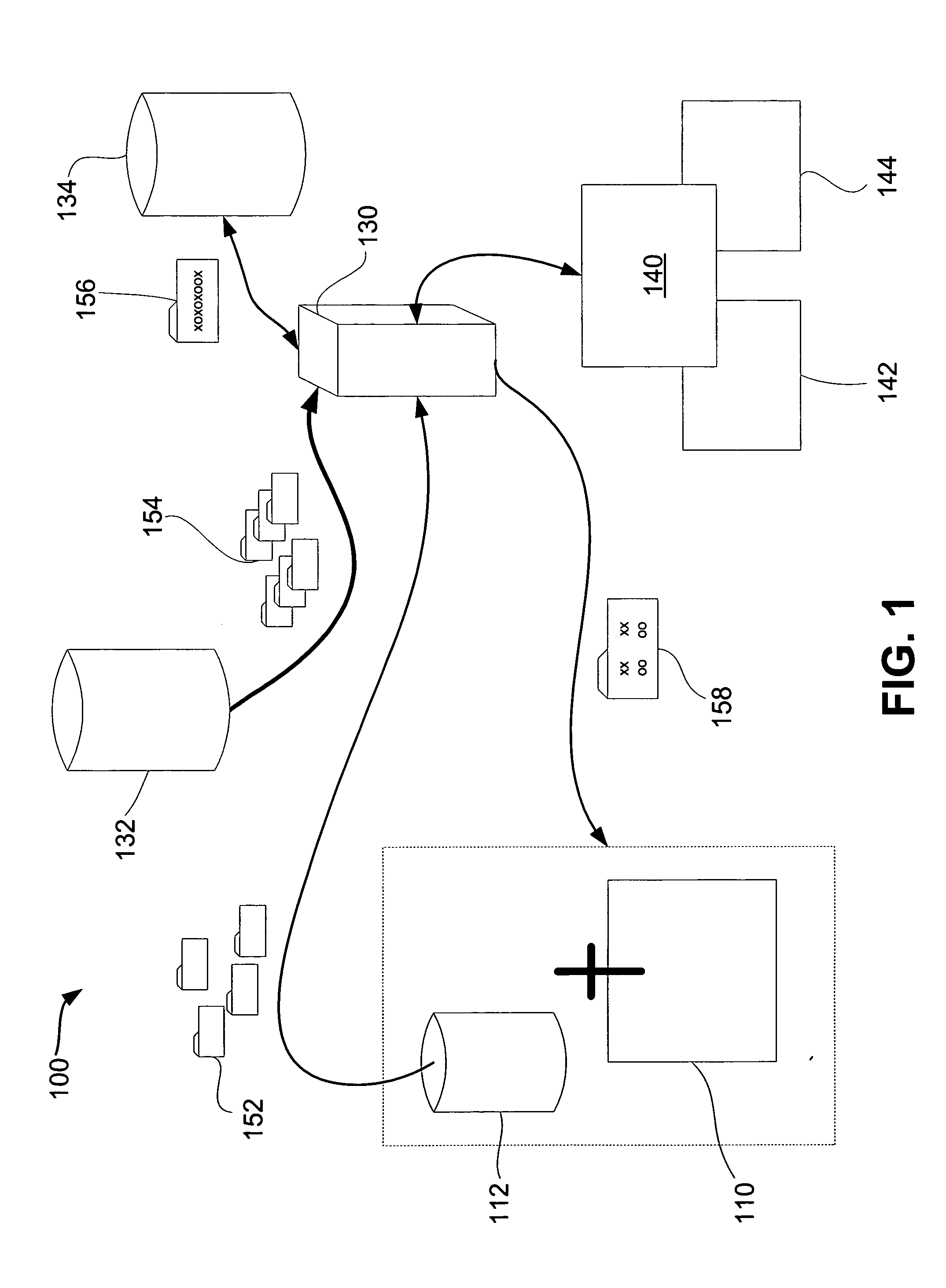

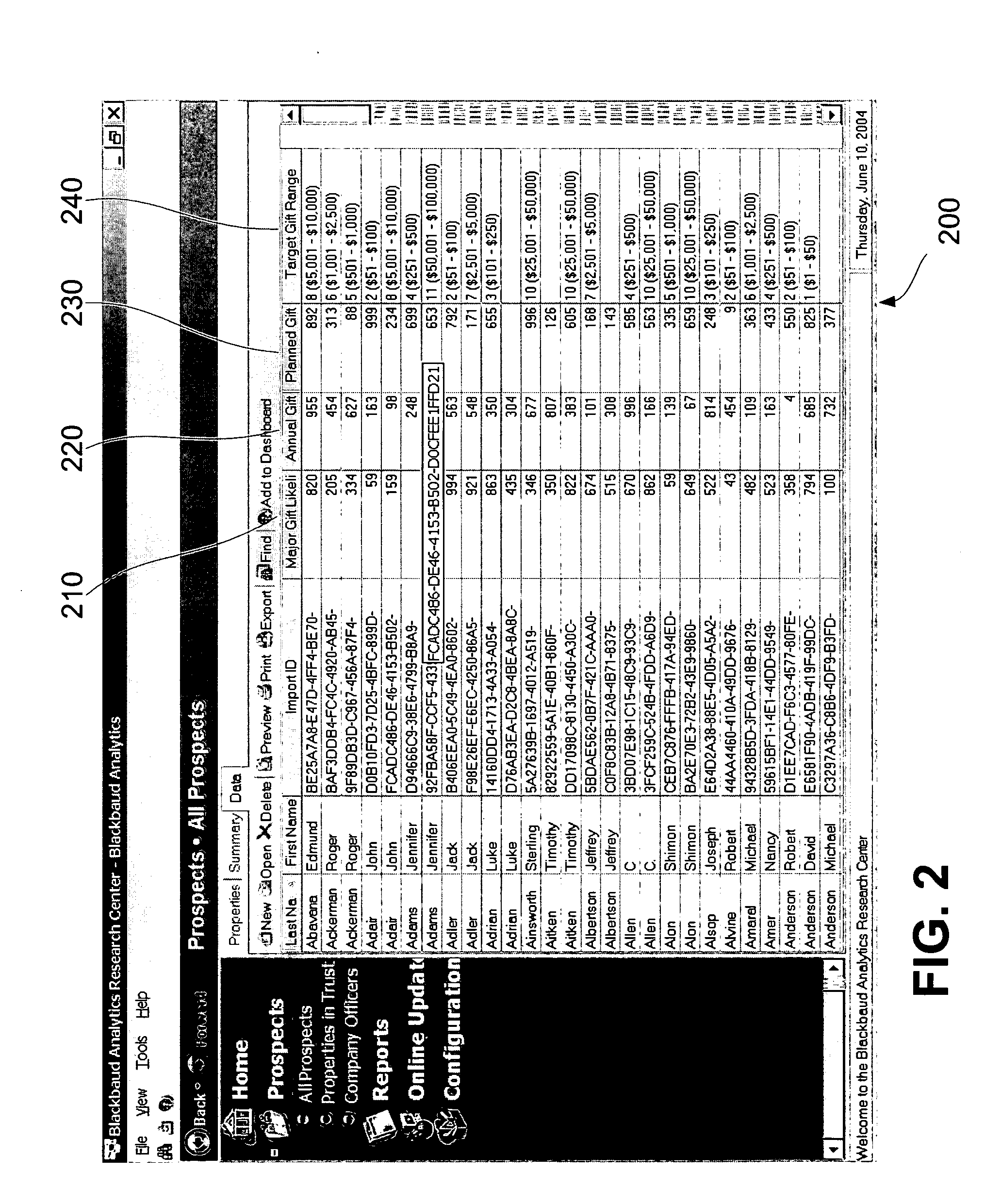

System and methods for maximizing donations and identifying planned giving targets

InactiveUS20050065809A1Accurate segmentationReducing expensive mailingFundraising managementOffice automationLimited resourcesNon profit

To enable a non-profit to make informed decision about how to spend its limited resources efficiently to maximize its donations, systems and methods to determine prospect propensity and prospect capacity to identify what types of donations, such as annual gifts, major one-time gifts, or planned gifts, the non-profit should solicit from its pool of prospective donors and the likely amount of each such gift. Systems and methods that enable the non-profit further to identify what types of planned gift, such as bequests, charitable remainder trusts, charitable gift annuities, pooled income funds, and life insurance, it should solicit from each of its prospective donors. The systems and methods use models developed using statistical analysis to generate relative scores for all prospective donors in the pool. Such scores and additional wealth information are provided to the non-profit in electronic format for further manipulation and use.

Owner:BLACKBAUD

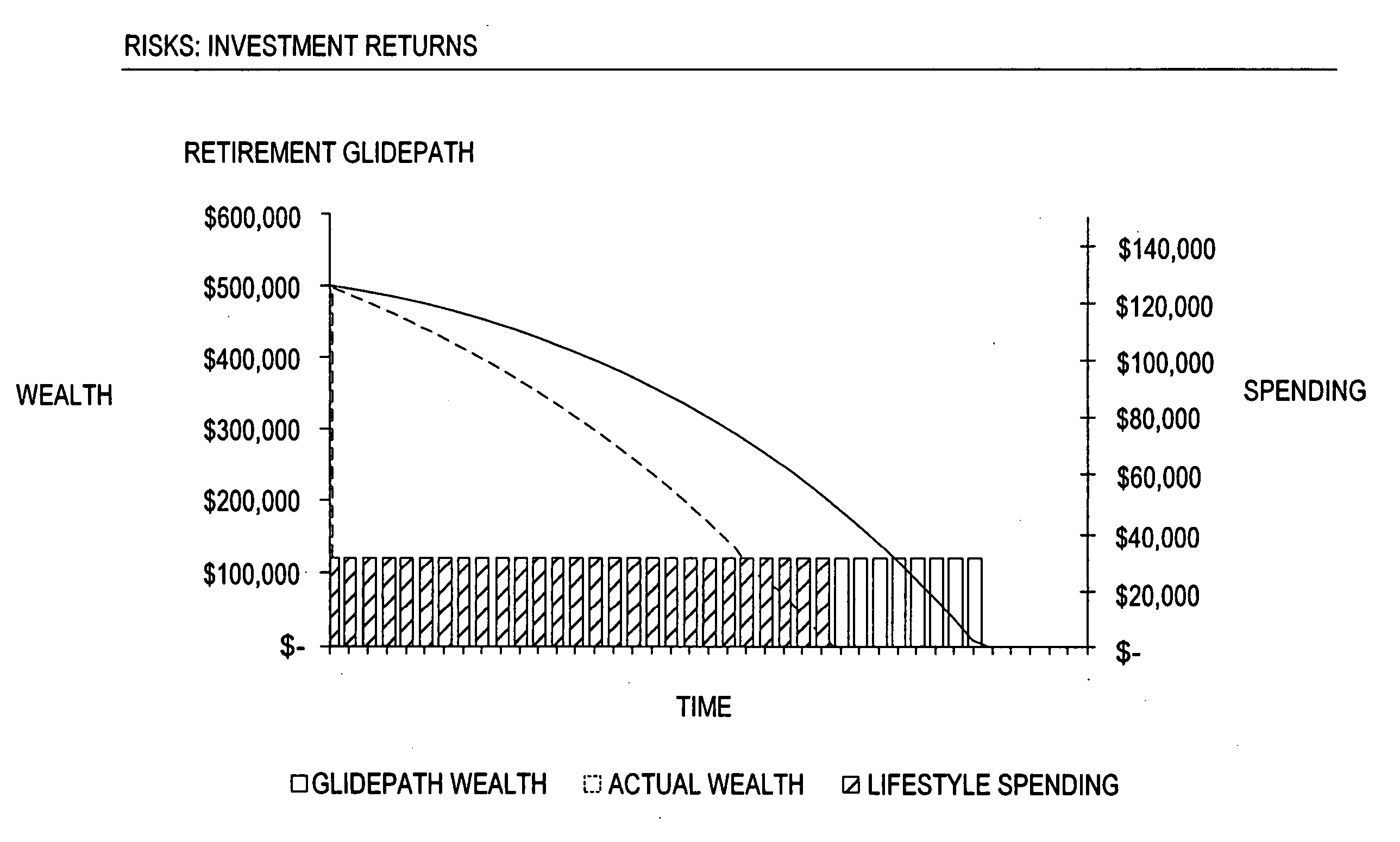

System, method and financial product for providing retirement income protection

A system and method and a financial income protection product are provided for enabling individuals who are approaching or are in retirement to ensure future sources of income with a reduced initial monetary outlay than conventional income protection products such as, for example, annuities. Income benefits are provided to the individuals only when they need it, i.e., either when market returns have not kept pace with expectations and / or when the individuals have lived beyond the point in time at which their expected wealth expires.

Owner:DELOITTE DEV

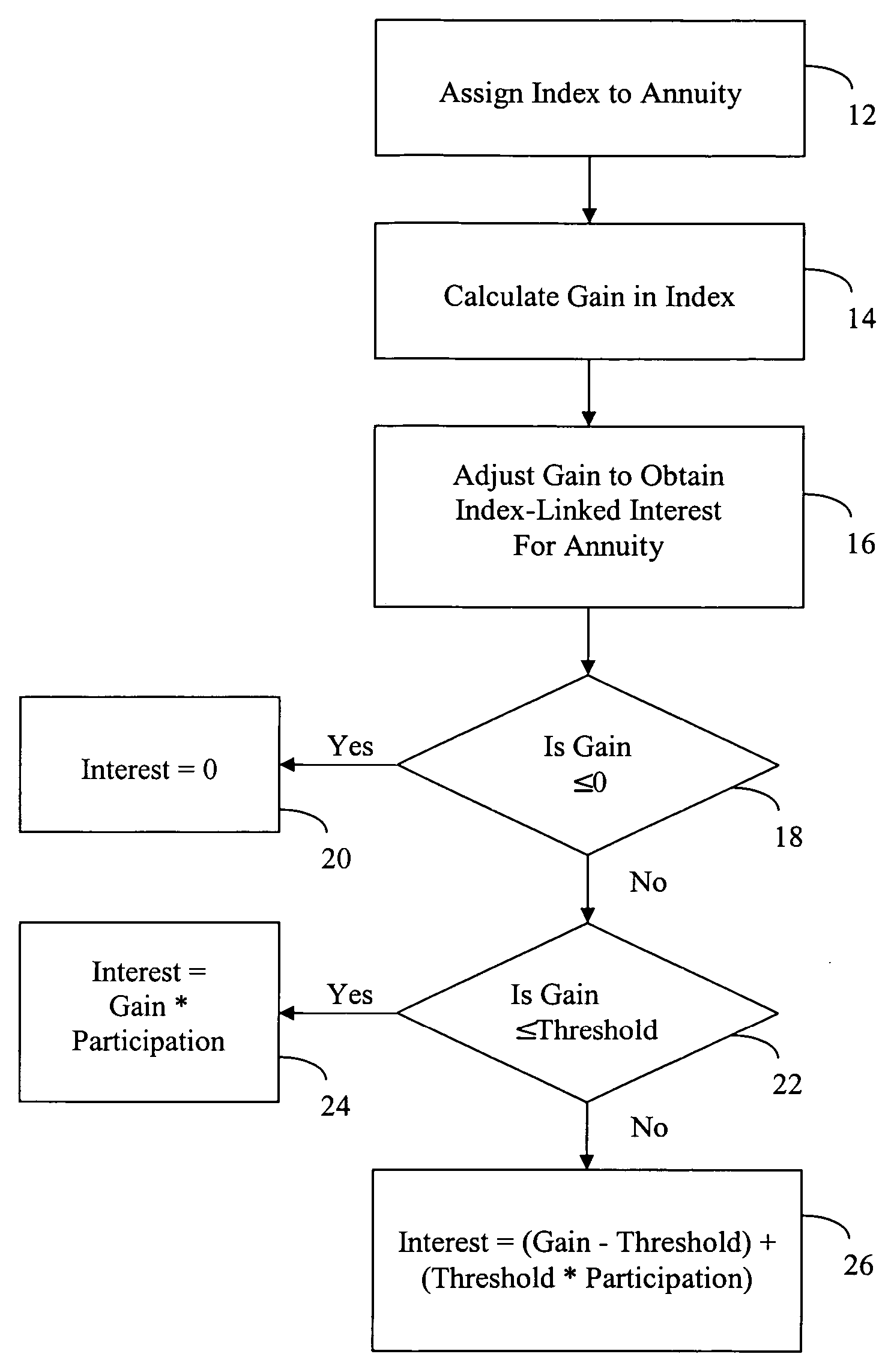

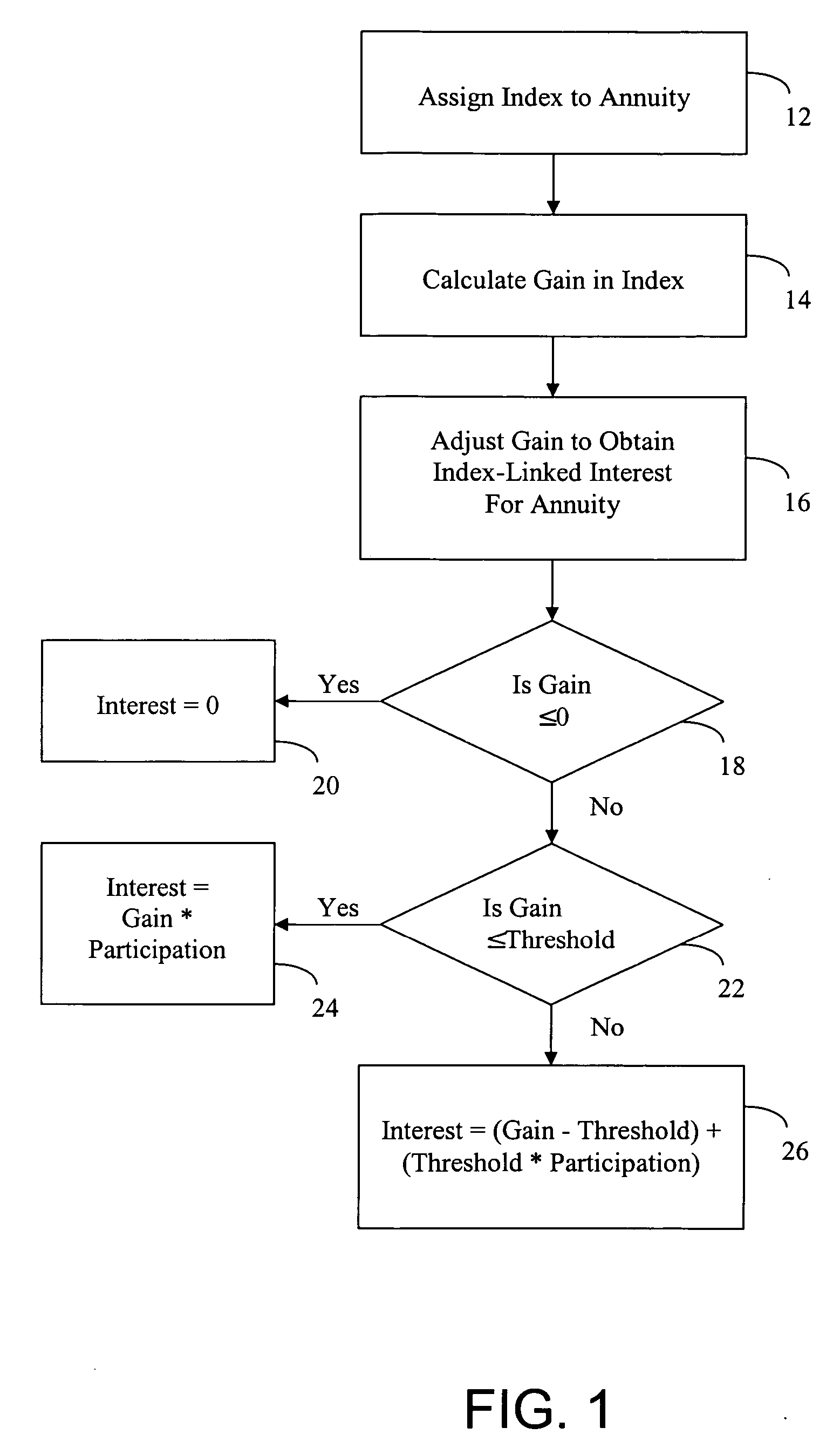

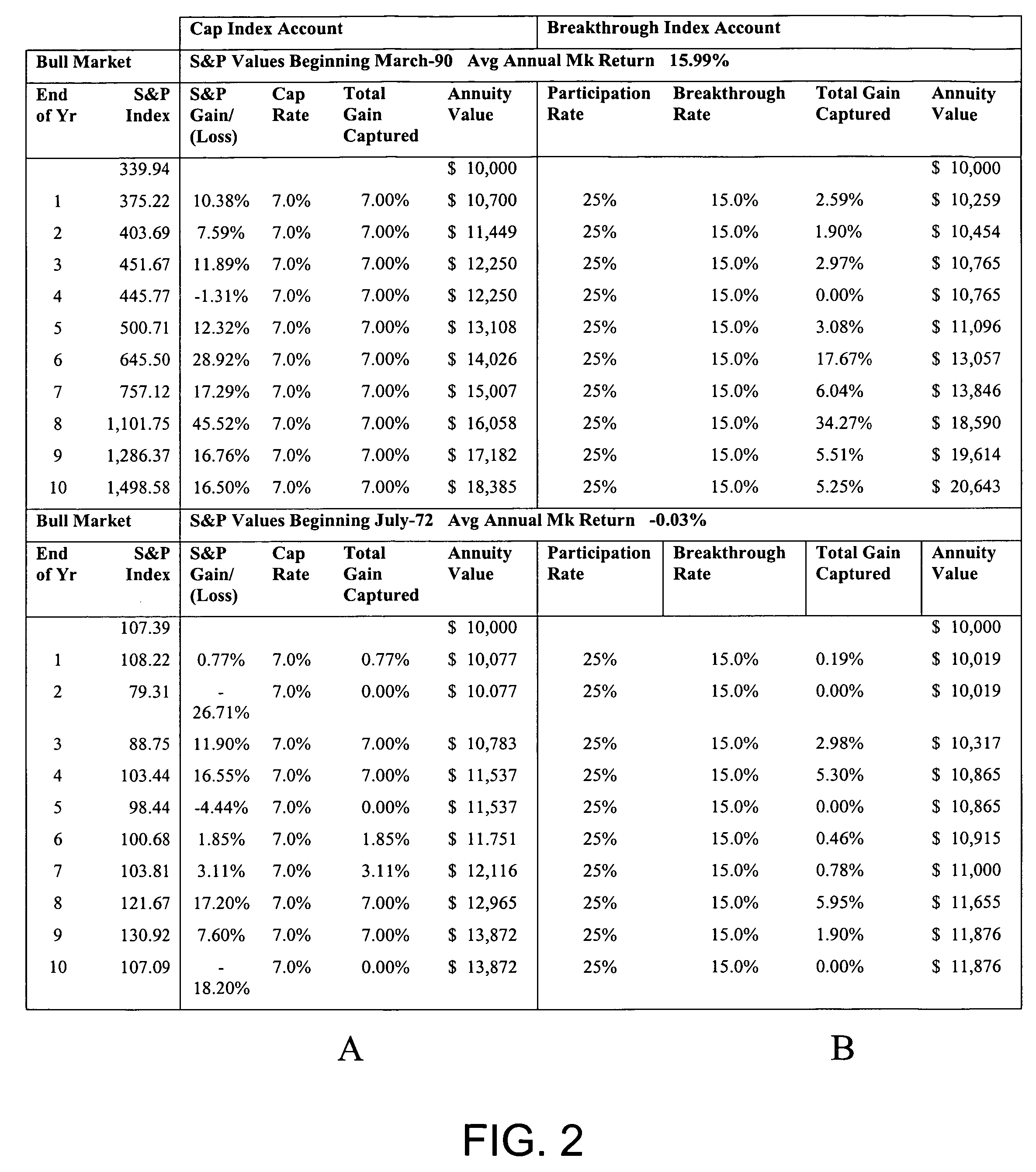

Annuity having an enhanced rate of return based on performance of an index

A computer implemented method of assessing an interest increase in an annuity linked to an index of equities includes determining a change in an equity index over a time period, setting an interest increase in an annuity to a floor if the determined change in the equity index is not greater than the floor, calculating the interest increase in the annuity to be a participation percentage of the determined change in the equity index if the determined change is greater than the floor where the participation percentage of the determined change is calculated up to a threshold change level in the determined change in the equity index, and adding an enhanced interest increase amount to the interest increase in the annuity if the determined change in the equity index is greater than the threshold change level. The enhanced interest increase amount is an enhanced percentage of the determined change in the equity index above the threshold change level.

Owner:AVIVA LIFE INSURANCE

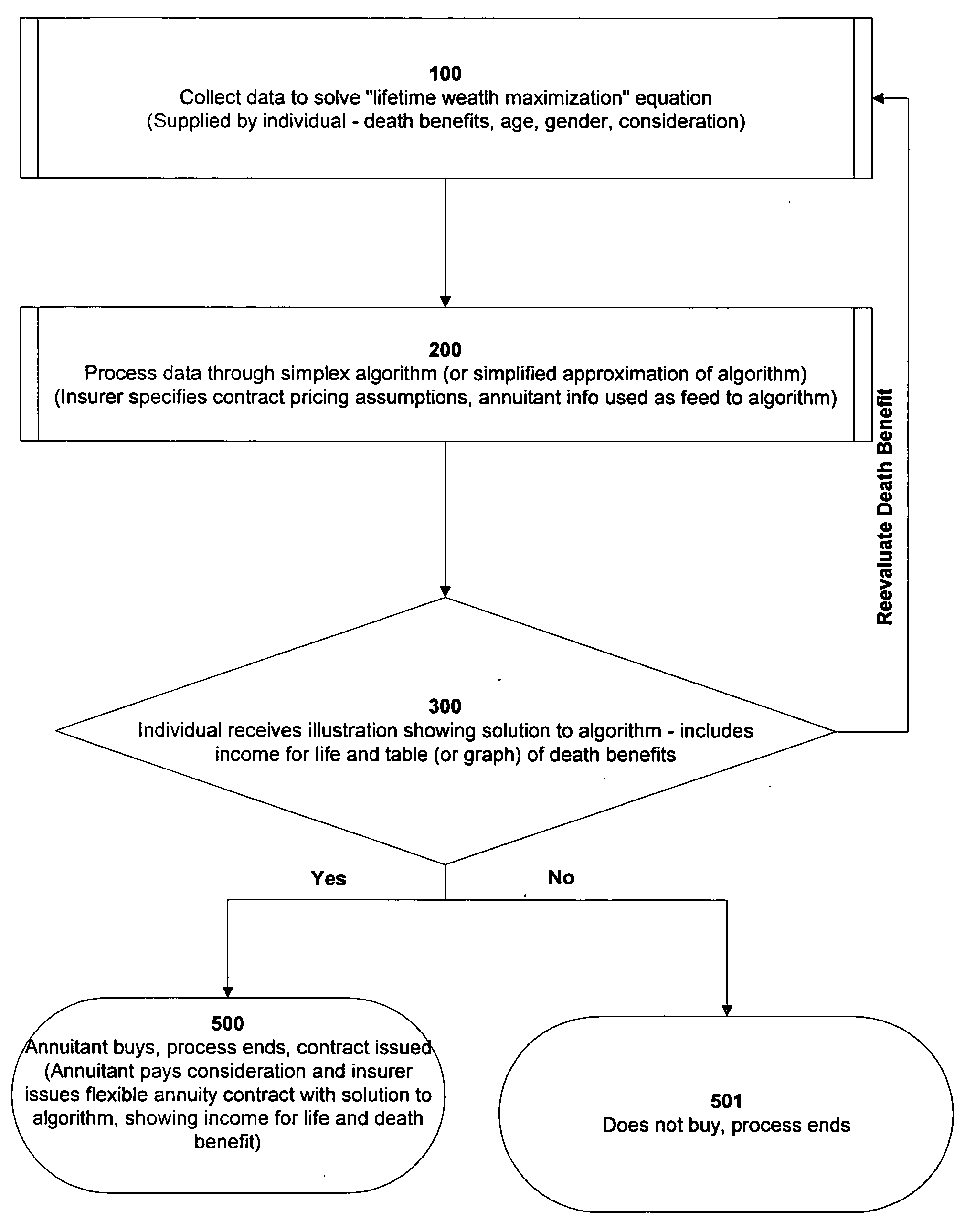

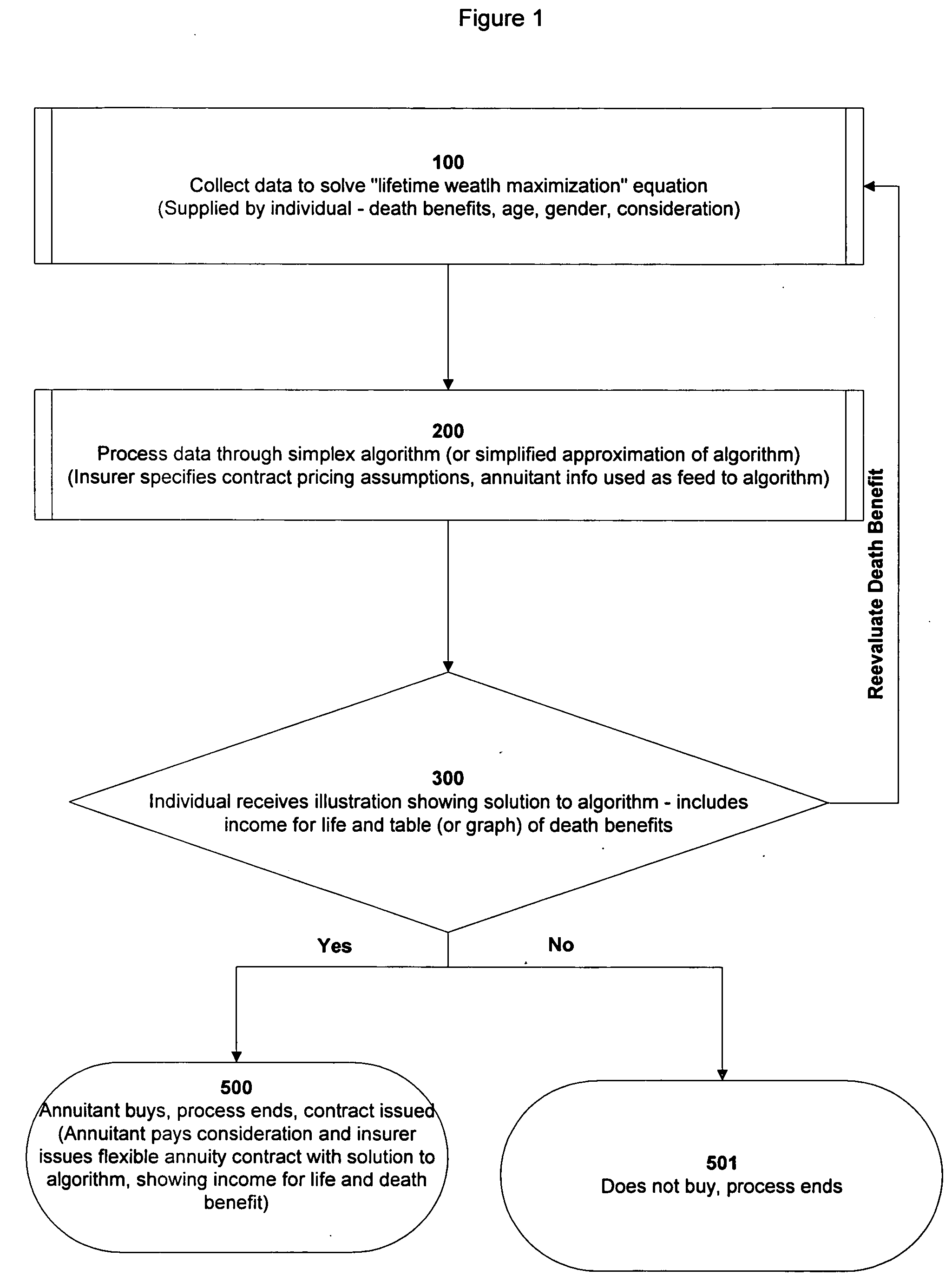

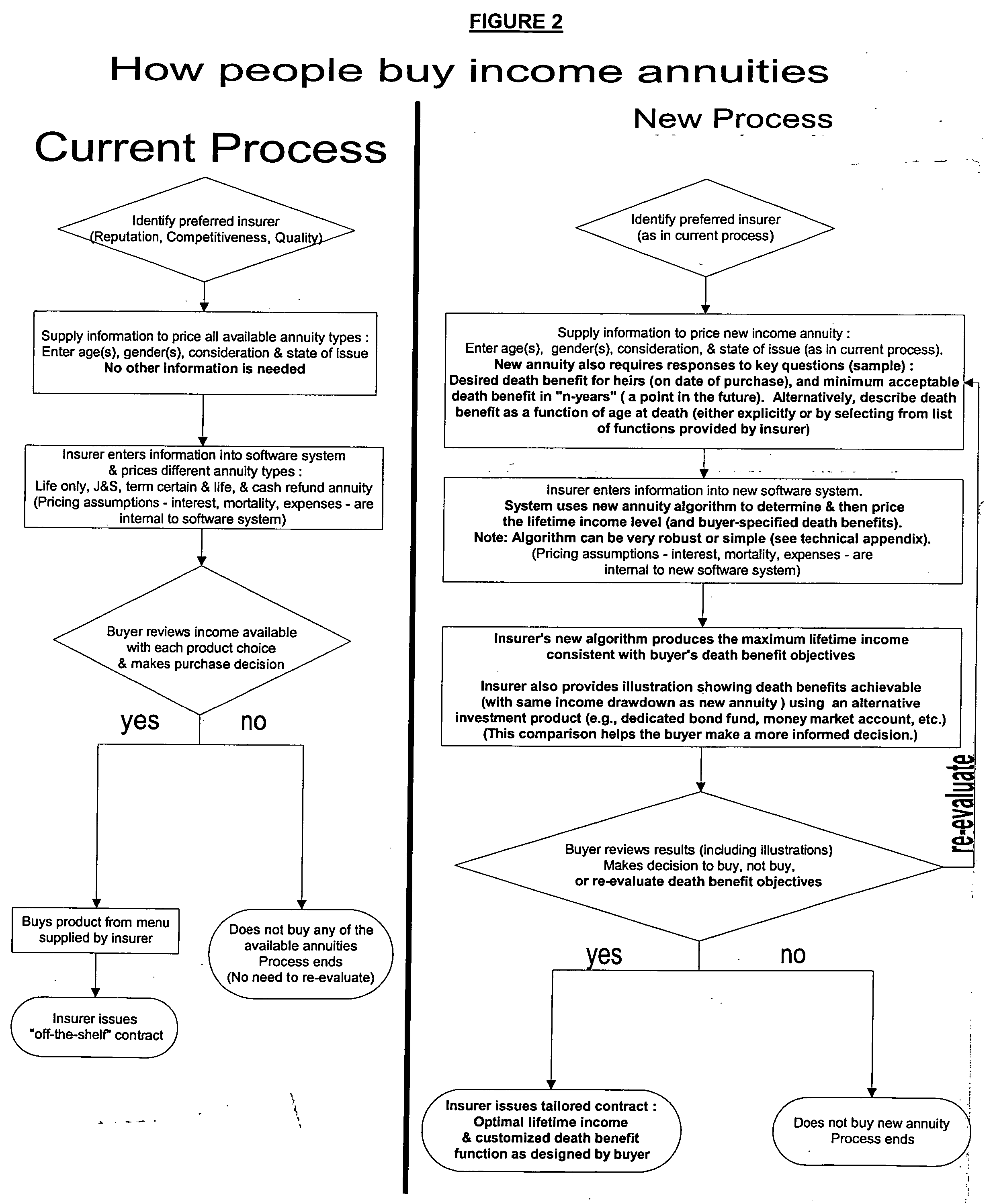

Method for determining an optimal and tailored lifetime income and death benefit package

An annuitant is able to select and optimize the allocation of a premium for insurance coverage between lifetime income benefits for the annuitant and death benefits to the annuitant's beneficiaries. A set of underwriting factors is established to provide the insurance coverage and value both the lifetime income to the annuitant and the death benefits payable to the beneficiaries. These factors include anticipated investment returns on the premium paid for the coverage, and which are used for both the income and death benefit components of the coverage. The annuitant uses these to derive a combination of lifetime income for the annuitant and death benefits available to the annuitant's beneficiaries. To do so, the annuitant inputs personal information including minimum dollar death benefit acceptable to the annuitant if the annuitant's death occurred immediately after the issue of the coverage, and the minimum death benefit to the designee if the annuitant's death occurs on or after some future date. This generates a solution showing the dollar death benefits payable in a lump sum to the beneficiaries at various possible dates of death into the future, as well as the corresponding lifetime income available for the annuitant.

Owner:FINANCIAL DESIGNS

System and method for creating a retirement plan funded with a variable life insurance policy and/or a variable annuity policy

A retirement plan is created using variable life insurance contracts and / or variable annuity contracts. Actuarial data used to create the retirement plan is entered via at least one user interface and processed. Based on the actuarial data, a variable life insurance policy and / or a variable annuity policy is generated for the purpose of funding the retirement plan. Additionally, a separate agreement is created that either extra-contractually modifies the variable life insurance policy and / or the variable annuity policy, or defines the terms under which the variable life insurance policy and / or the variable annuity policy is to be used in the retirement plan.

Owner:KORESKO JOHN J V

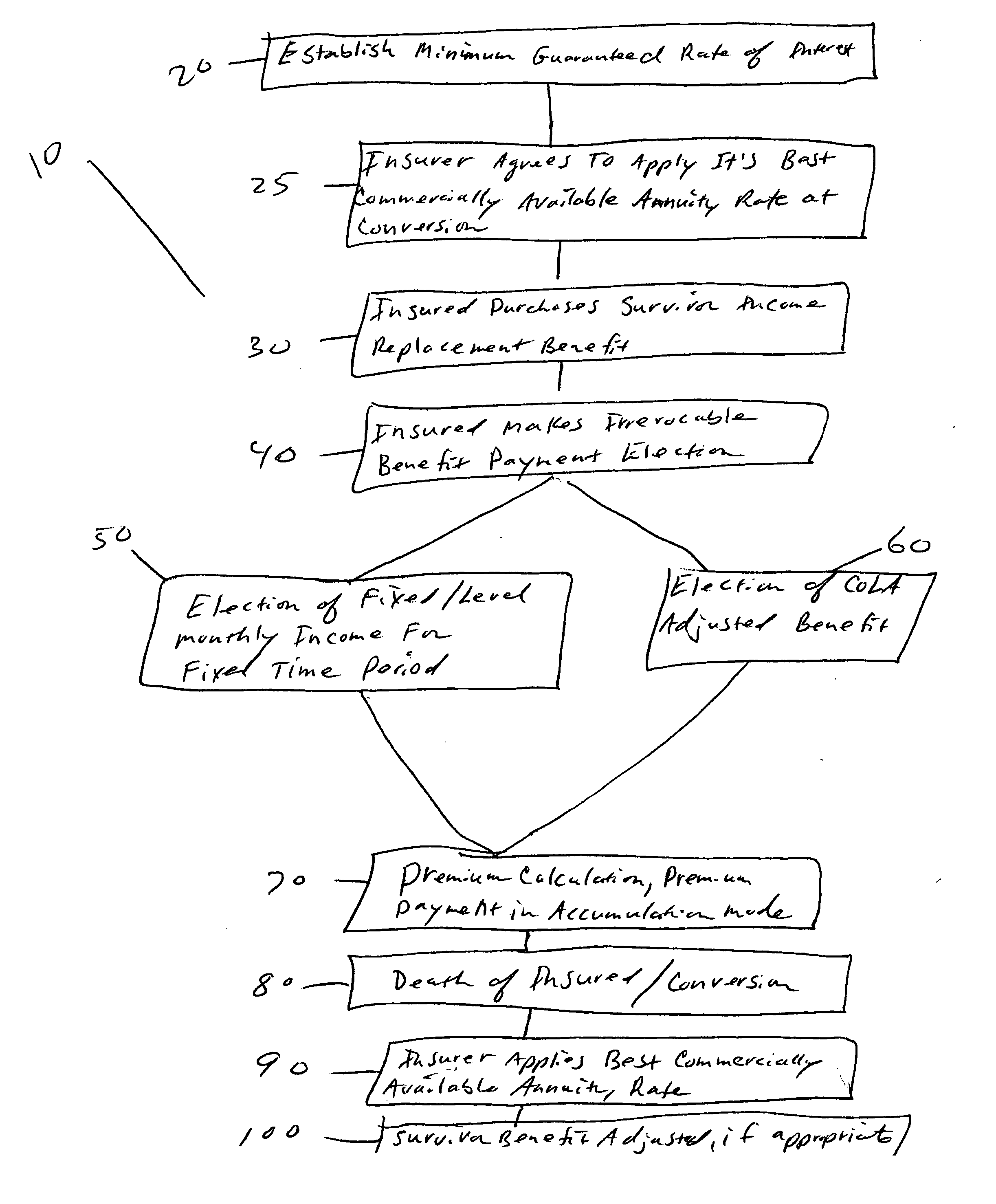

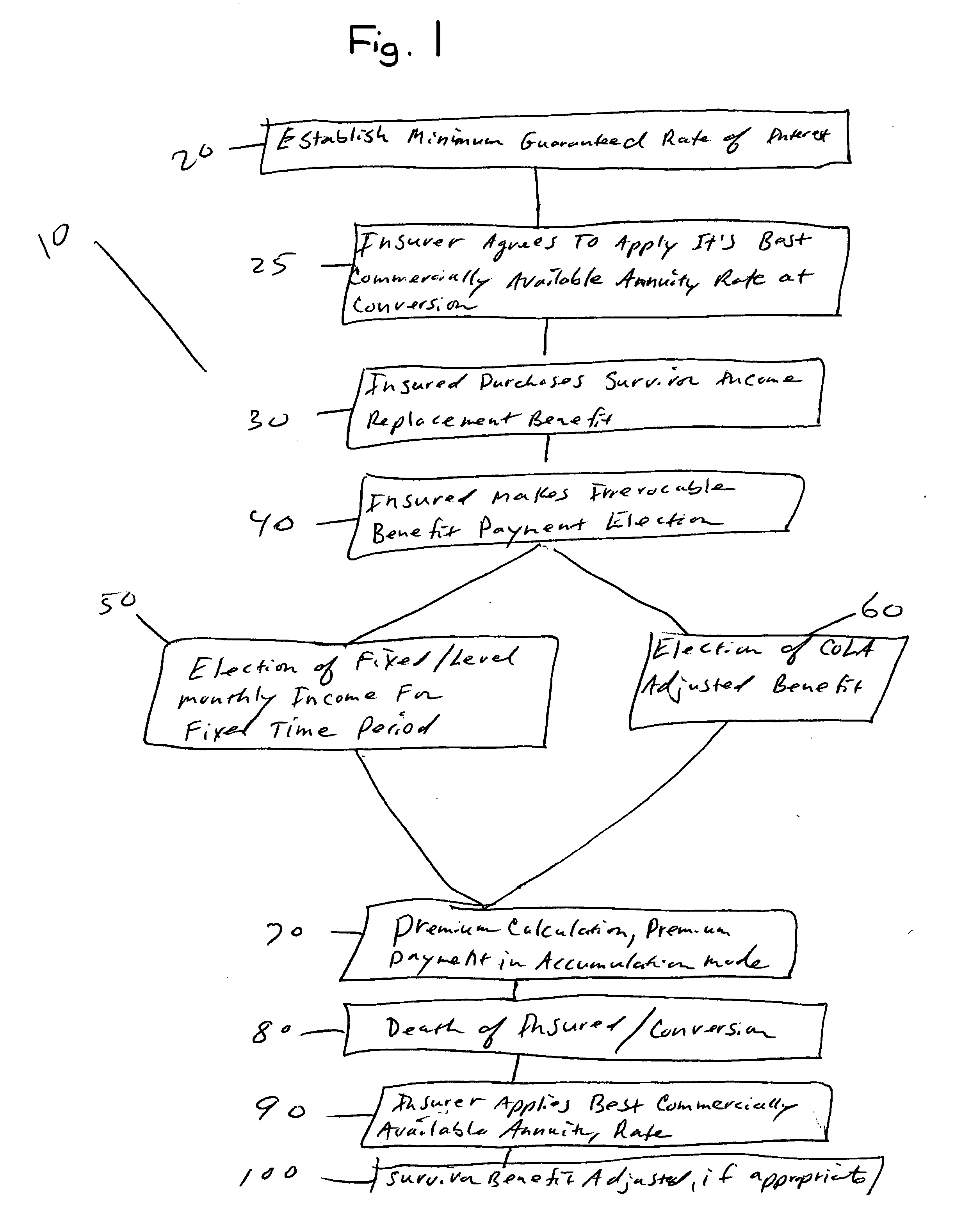

Survivor benefit plan, method and computer program product for providing a survivor income-replacement plan that is adjusted for inflation

A method and computer program product for providing survivor income-replacement benefits having a guaranteed rate of interest with the possibility of a higher income stream to the designated survivor if supported by prevailing interest rates at the time of annuitization. In one embodiment, the insured would purchase either a fixed level dollar amount of monthly income for a fixed period of time or a Cost of Living Adjusted (COLA) benefit in the form of a monthly annuity. The insurance carrier is required to contractually guarantee a minimum rate of interest, e.g., 3% at the time of annuitization. The insurance carrier is further required to apply the same discount rate to the annuity contract that is provided to the best commercially available immediate annuity contract the carrier offers at the time of annuitization, subject to the minimum guaranteed rate of interest. Thus, the beneficiary may receive an increased income stream if the relevant interest rate at the time of the purchaser's death exceeds the guaranteed minimum interest rate. Thus, if the insured purchased a survivor benefit under the inventive method with a 3% guaranteed minimum COLA, and if the best commercially available immediate annuity interest rate is 6%, the benefit paid the beneficiary survivor is increased annually at a rate of 6%. Without COLA, the contract simply starts paying higher level monthly benefits based on the higher 6% discount rate.

Owner:ASSOCD FINANCIAL GROUP

System for managing the total risk exposure for a portfolio of loans

A computer system for monitoring and enhancing the collateral security underlying a set of loans is provided, including a system for calculating the unsecured value of the set at any time and for initiating additional collateral enhancement instruments when the unsecured value exceeds a certain limit. The system may include a variety of modules in communication with a relational database for storing data about the loans and system elements. The computer system may also be configured to allocate, manage, and execute the waterfall or cascade of funds between and among the various participants in a financial plan. The invention also includes a structured finance plan and related methods for enhancing the collateral security of a loan obtained for a life insurance or annuity product, and a system and method for managing a portfolio of such loans in order to obtain favorable financing and to facilitate securitization.

Owner:ENTAIRE GLOBAL INTPROP

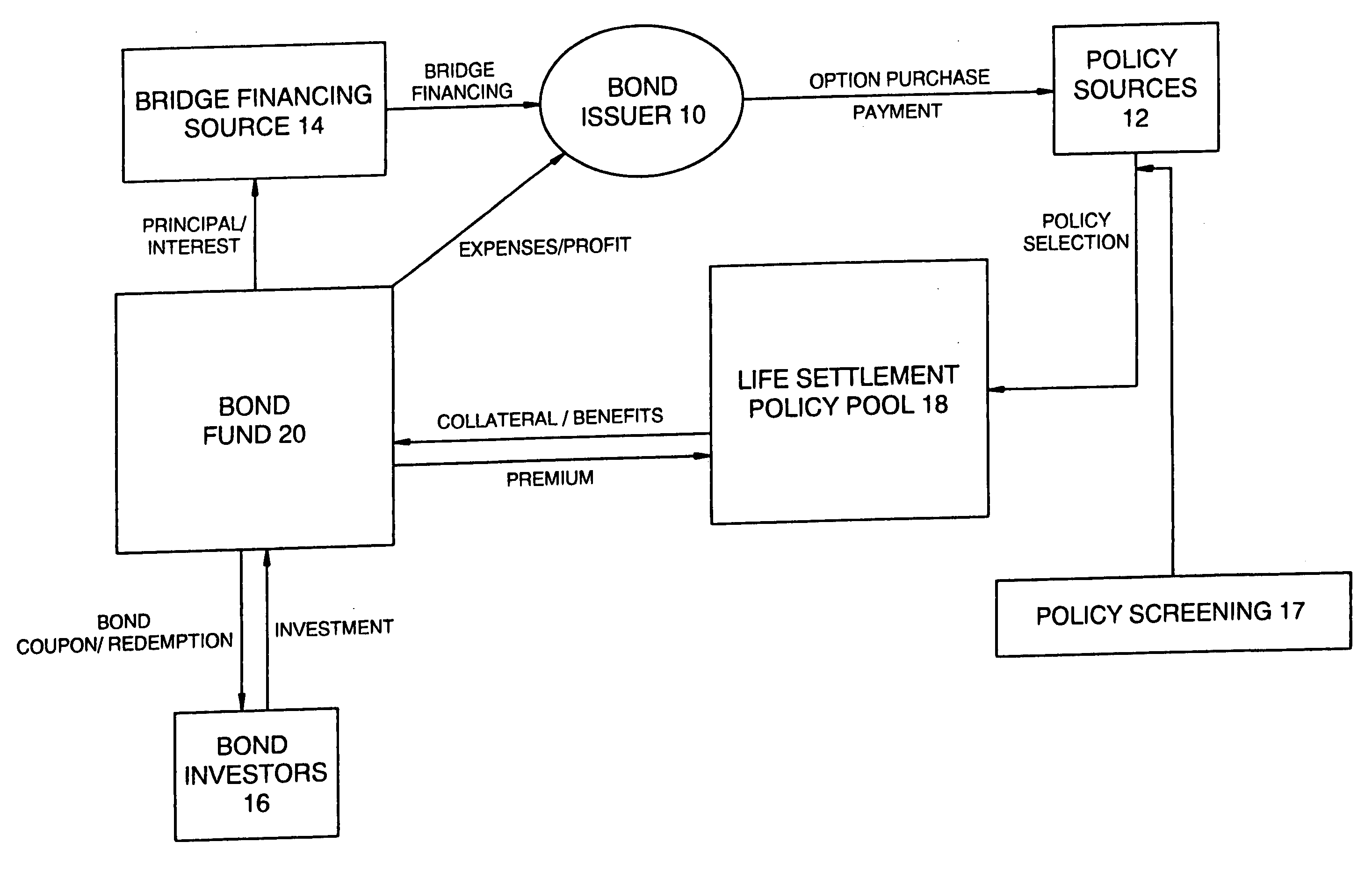

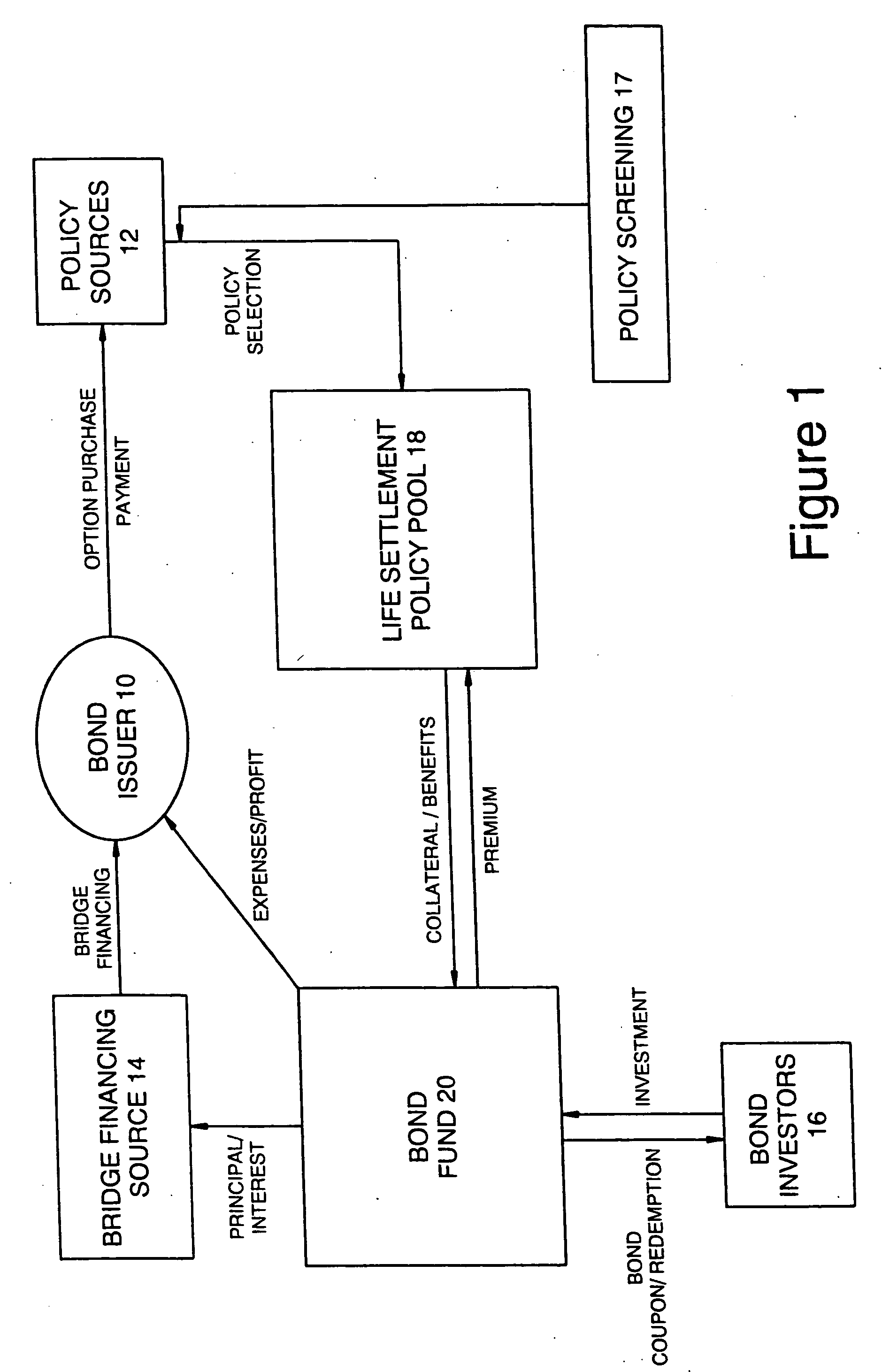

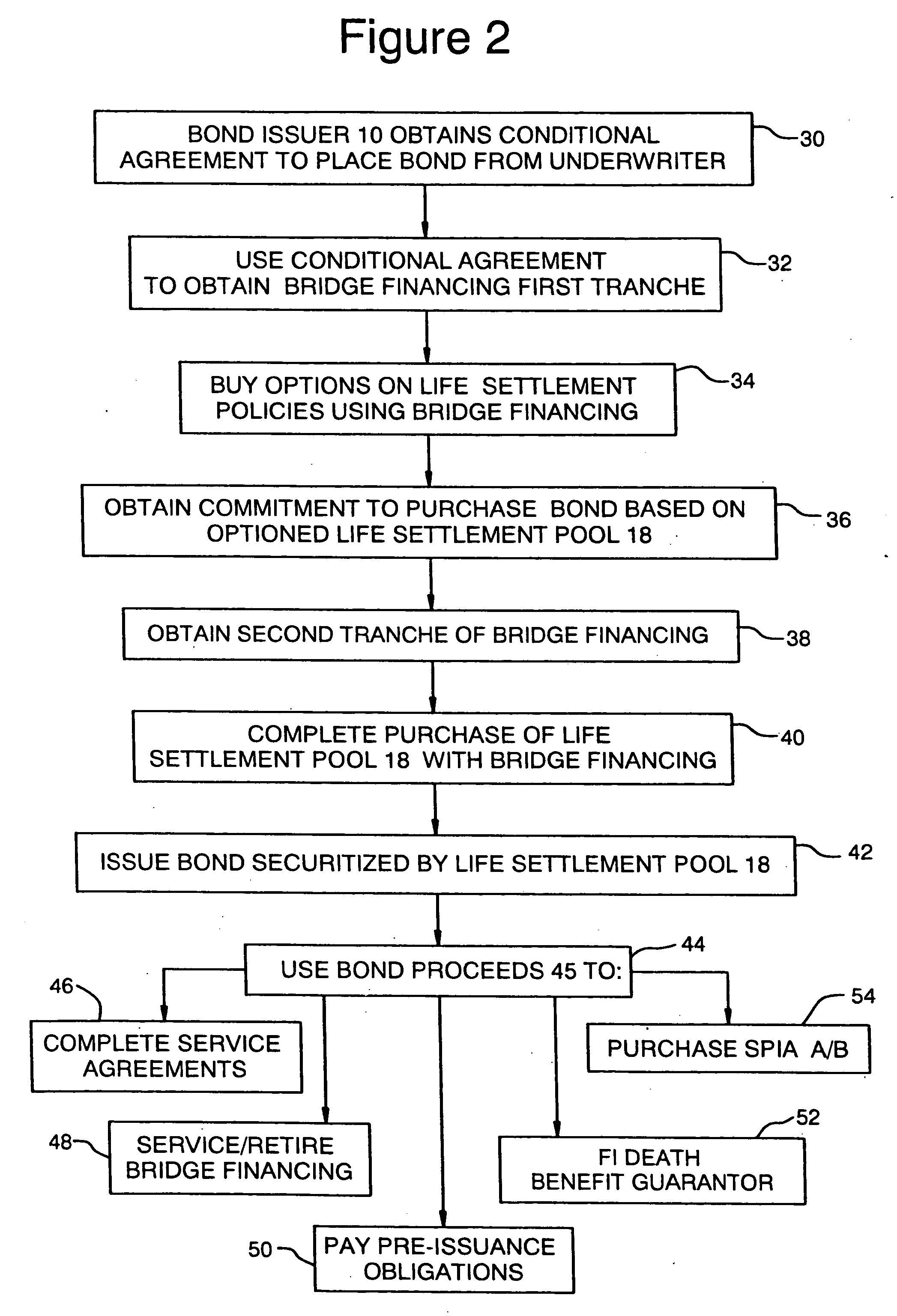

Capital market products including SPIA securitized life settlement bonds and methods of issuing, servicing and redeeming same

InactiveUS20050216316A1Good financial qualityFinanceSpecial data processing applicationsEngineeringAnnuity

Disclosed are novel capital market products, e.g. bonds, equities and like, employing a life settlement policy pool as collateral against repayment of principal. One embodiment is a securitized life settlement bond collateralized by a pool of about 800 senior life settlement policies each bearing death benefits expected to mature within the bond term. At least one single premium immediate annuity (“SPIA”) can be employed to securitize the coupon payments on the bond. Also, an investment instrument, optionally an impaired-risk SPIA can be used to securitize and guarantee the policy premium payments for the life of the insured. Included are methods of pre-funding the costs of supporting the issued bond to make the bond bankruptcy-remote and eligible for a high rating.

Owner:DONALD W BRITTON +2

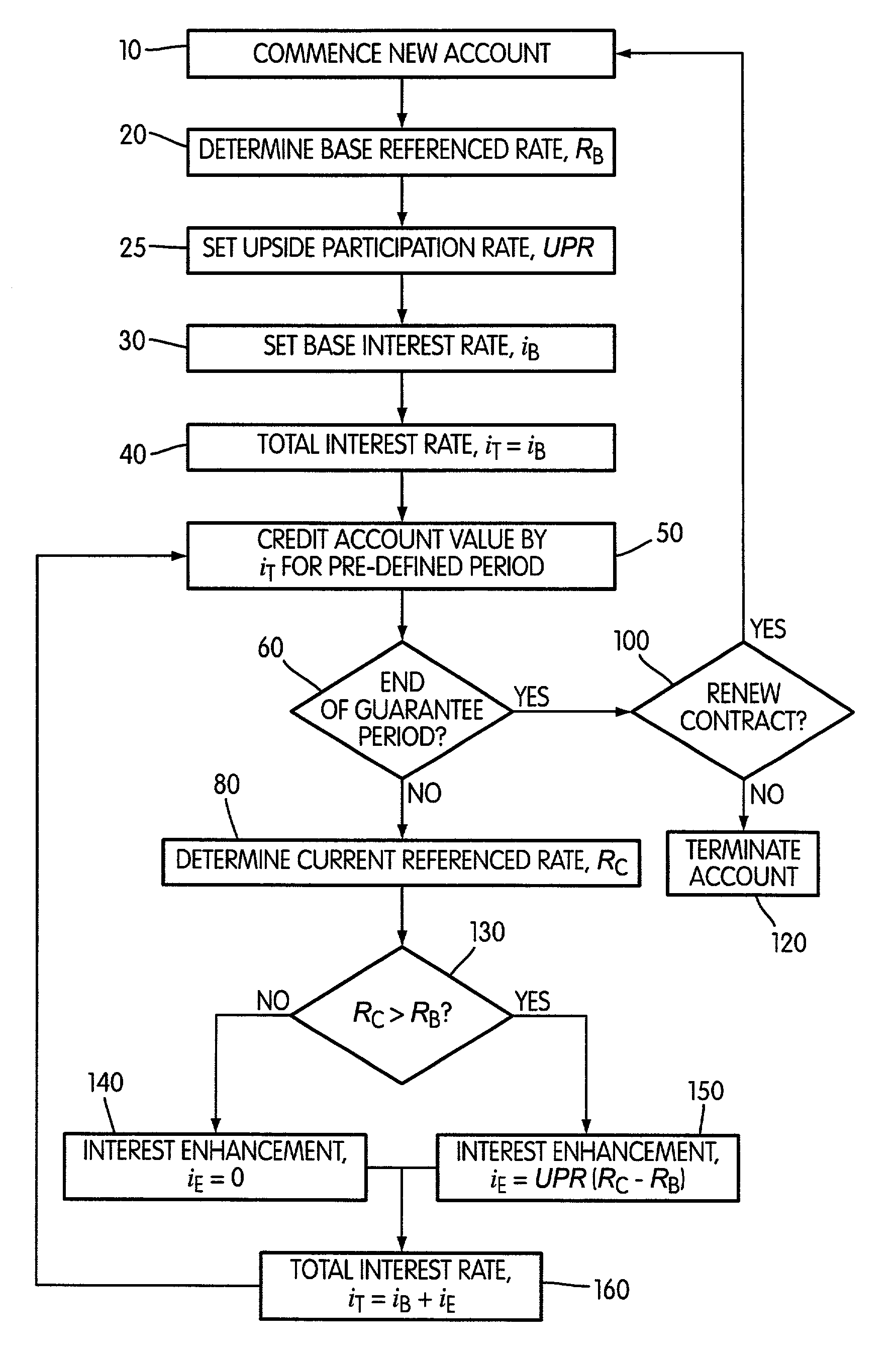

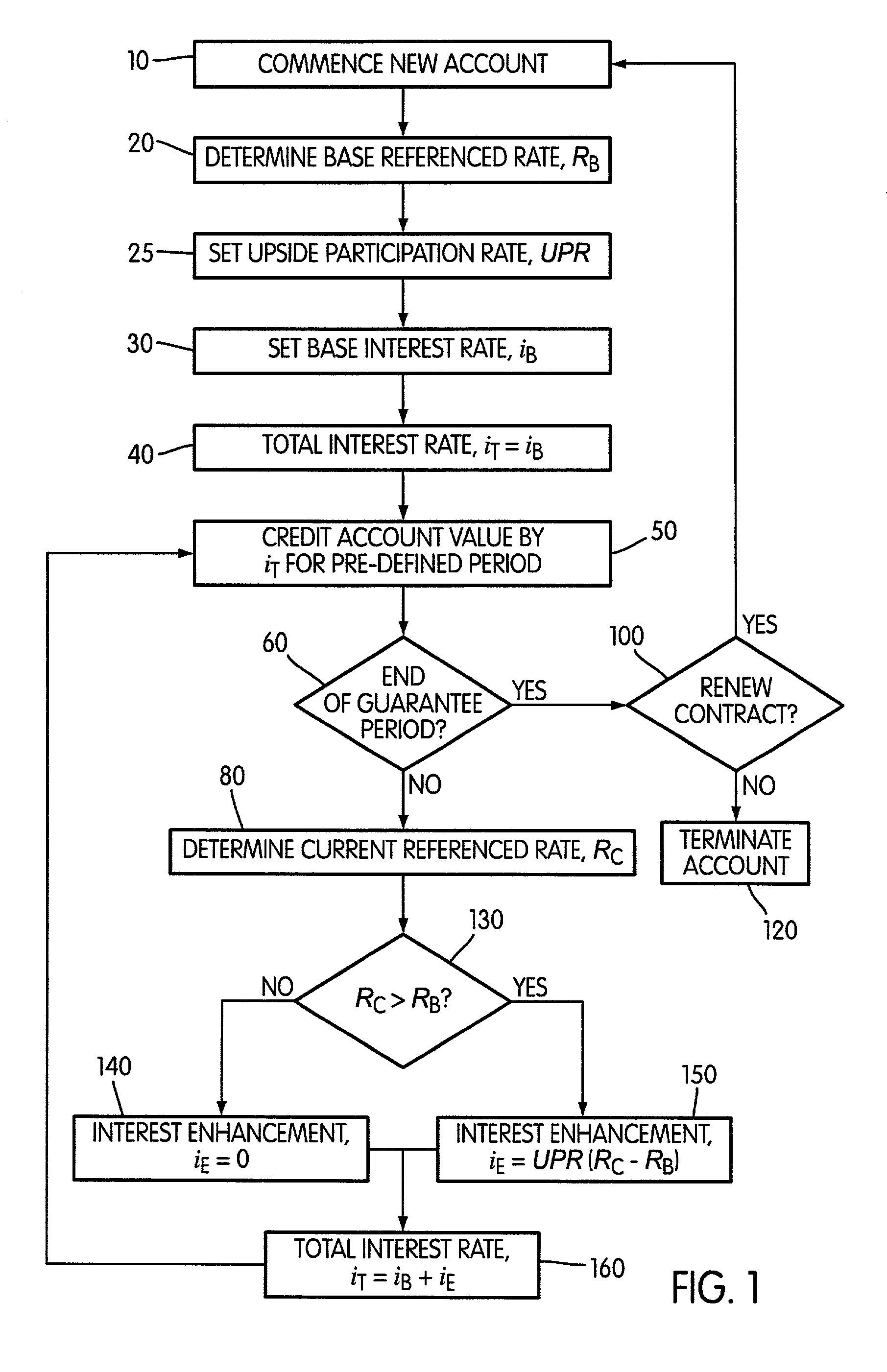

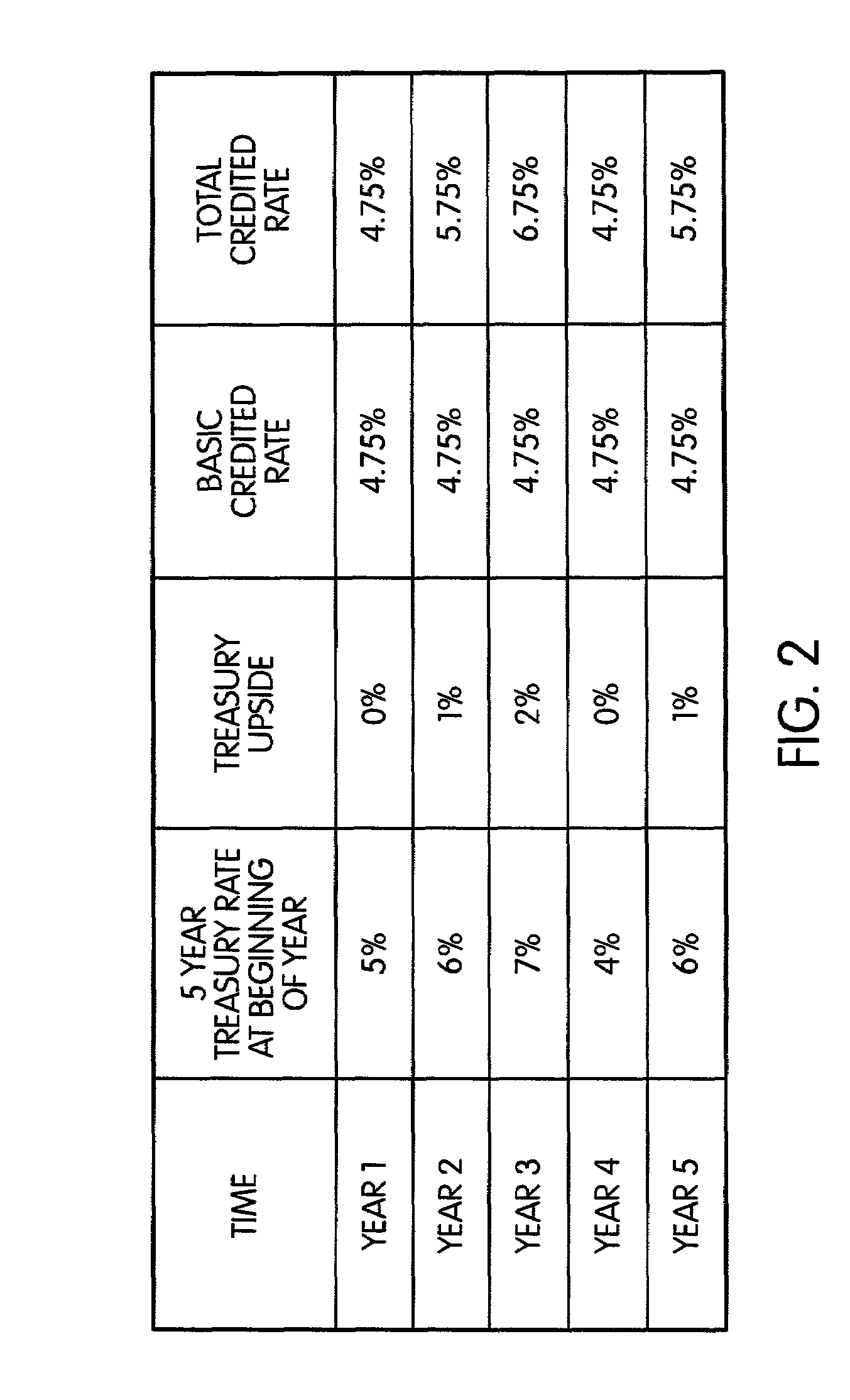

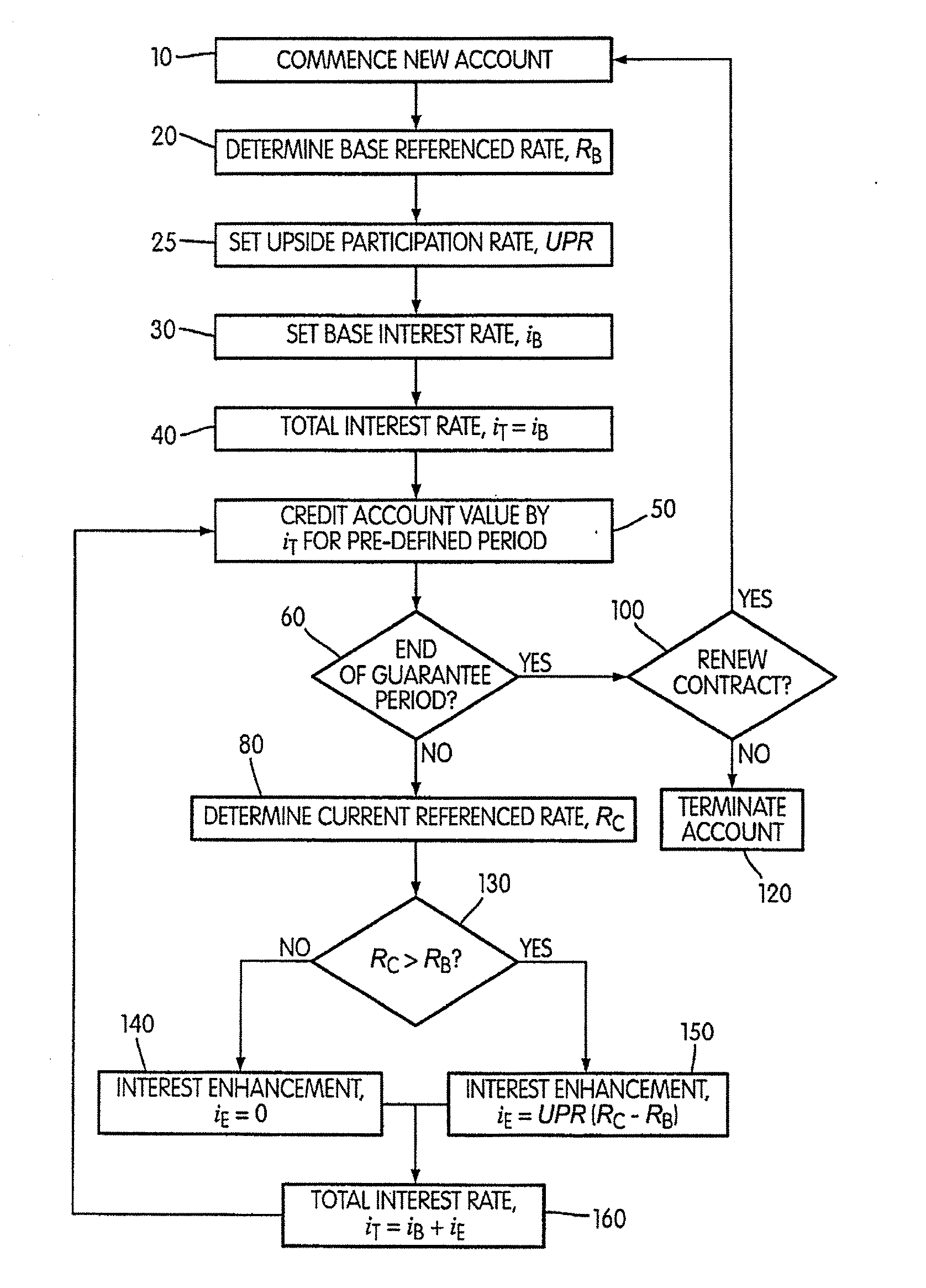

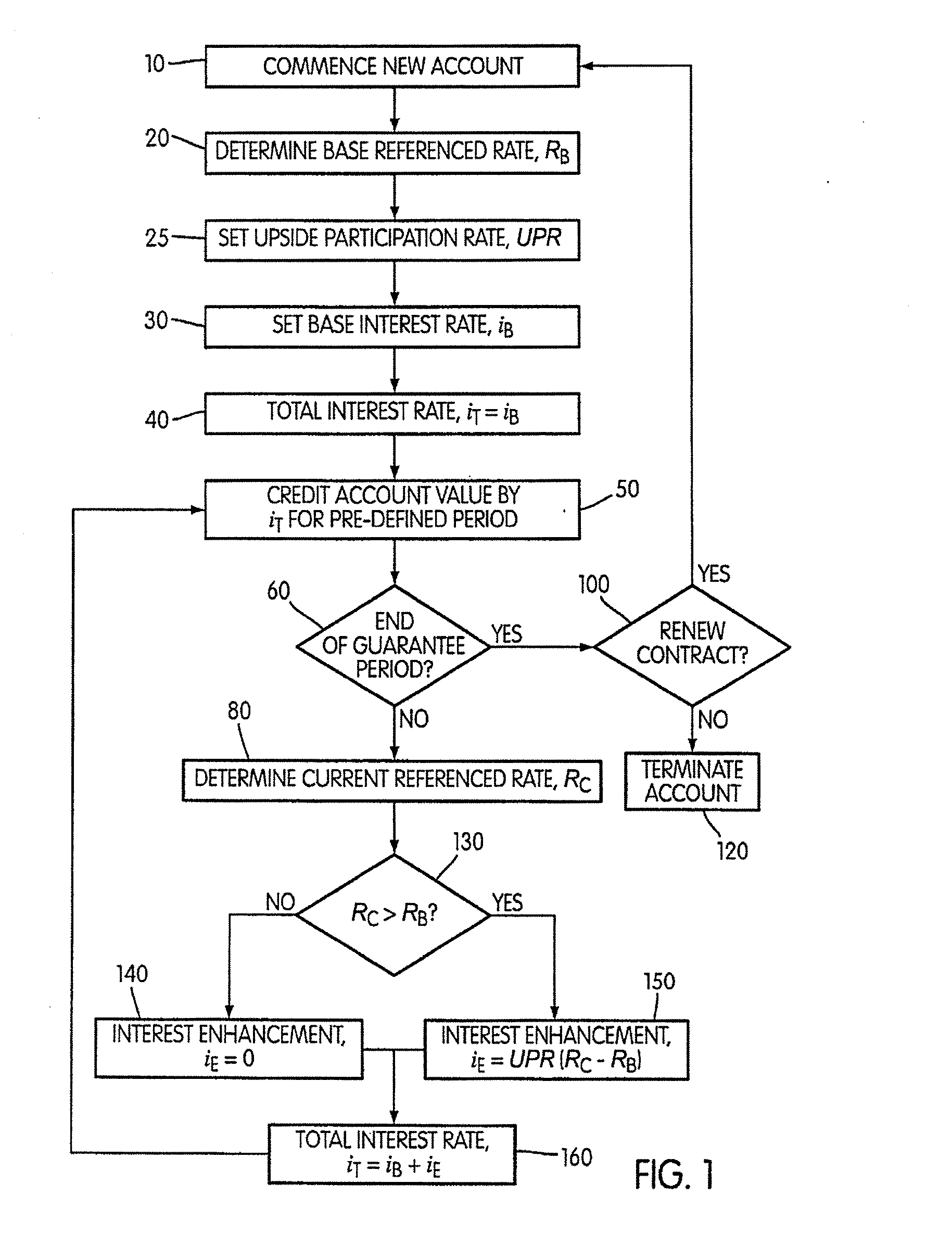

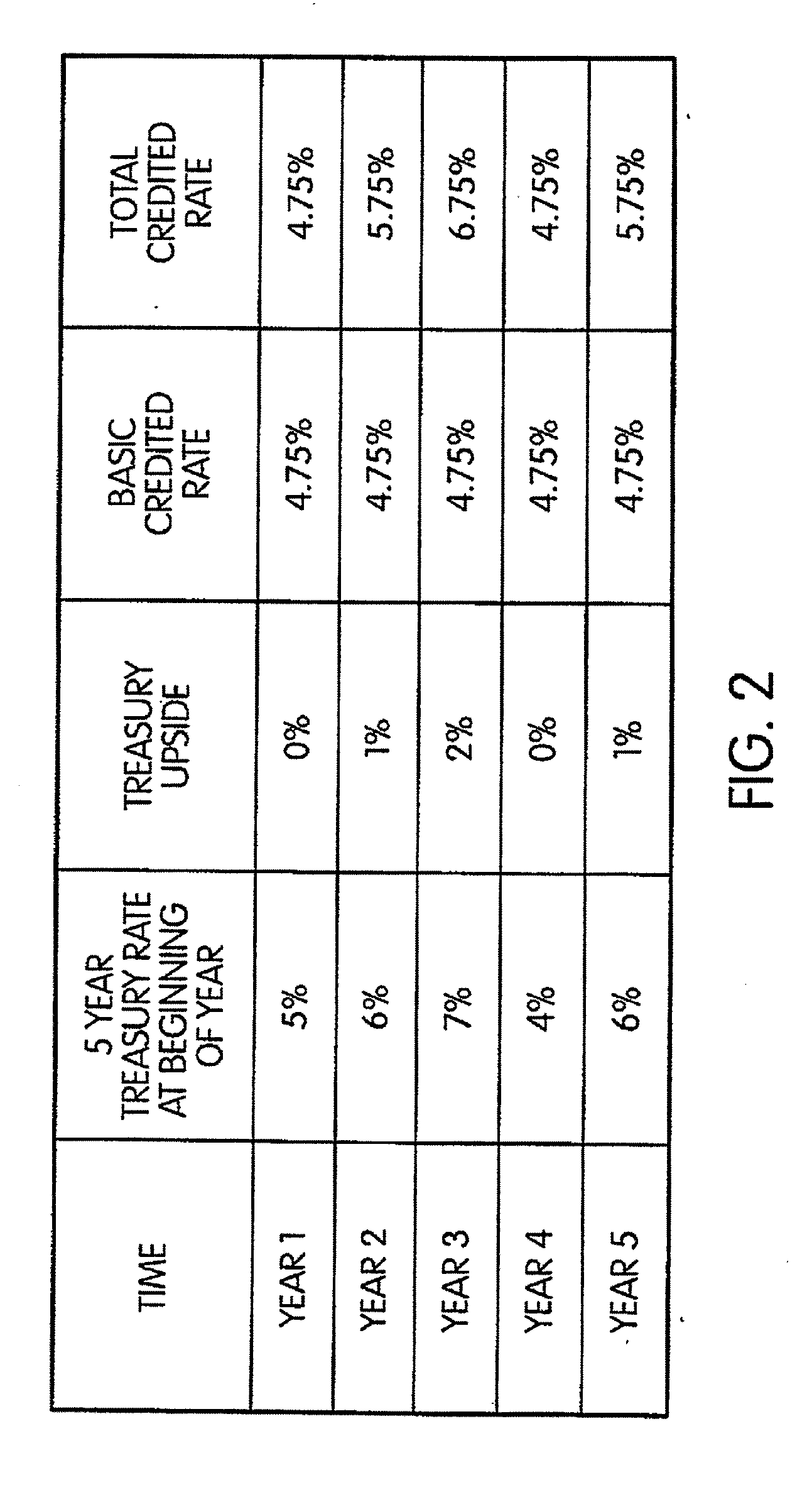

Annuity having interest rate coupled to a referenced interest rate

An annuity provides a guaranteed rate of return for a guarantee period while at the same time providing upward adjustments to the interest rate if there is a corresponding increase in a specified referenced rate, which may be a United States Treasury rate or an interest rate that is used to settle a contract that is traded on a financial futures exchange. The guaranteed base interest rate is set at the beginning of the guarantee period, and the annuity account is credited with the base interest rate for an initial pre-defined period, which is some portion of the guarantee period. Periodically, as defined by the pre-defined period, the then-current referenced rate is compared to a base referenced rate that was defined at the establishment of the guarantee period. If the referenced rate has increased, the interest rate that will be credited to the annuity account value will increase by an amount that is based on the amount of increase in the referenced rate. If the referenced rate has not changed or has decreased, the interest rate that will be credited to the annuity account value will be the guaranteed base interest rate that was set at the beginning of the guarantee period.

Owner:ALLSTATE INSURANCE

Annuity Having Interest Rate Coupled to a Referenced Interest Rate

An annuity provides a guaranteed rate of return for a guarantee period while at the same time providing upward adjustments to the interest rate if there is a corresponding increase in a specified referenced rate, which may be a United States Treasury rate or an interest rate that is used to settle a contract that is traded on a financial futures exchange. The guaranteed base interest rate is set at the beginning of the guarantee period, and the annuity account is credited with the base interest rate for an initial pre-defined period, which is some portion of the guarantee period. Periodically, as defined by the pre-defined period, the then-current referenced rate is compared to a base referenced rate that was defined at the establishment of the guarantee period. If the referenced rate has increased, the interest rate that will be credited to the annuity account value will increase by an amount that is based on the amount of increase in the referenced rate. If the referenced rate has not changed or has decreased, the interest rate that will be credited to the annuity account value will be the guaranteed base interest rate that was set at the beginning of the guarantee period.

Owner:ALLSTATE INSURANCE

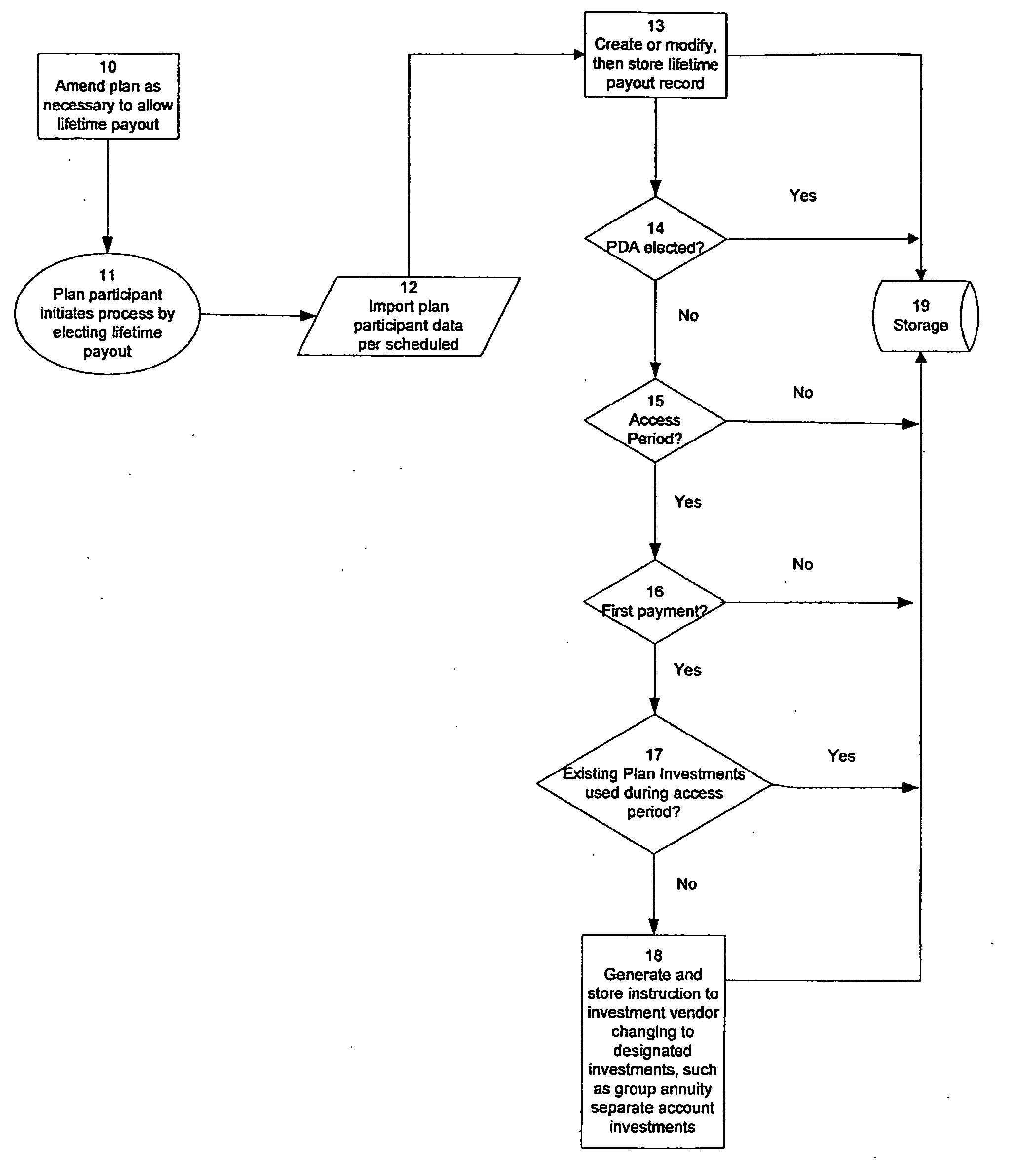

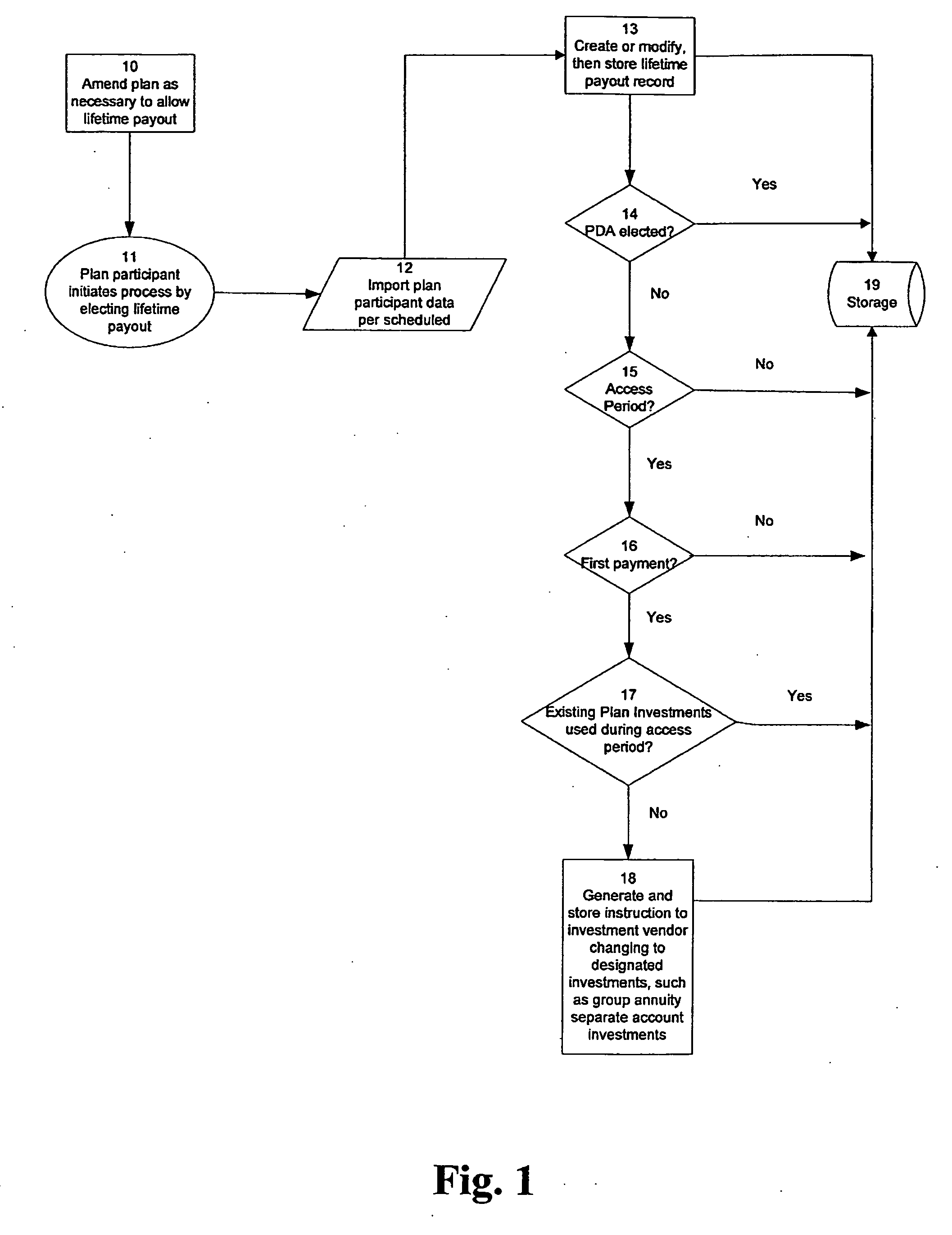

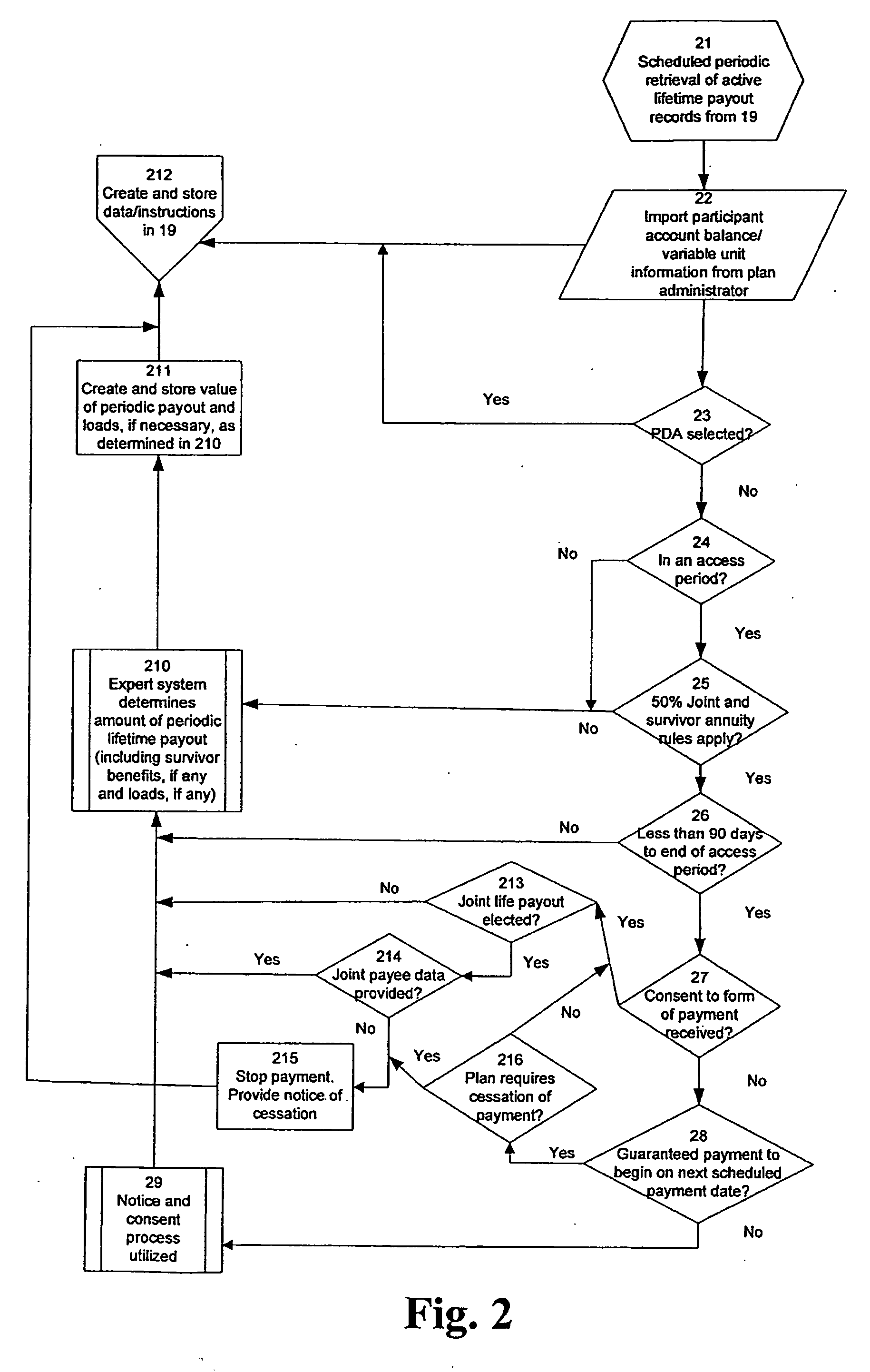

Method and system for providing employer-sponsored retirement plan

A method of administering income distributions from an employer-sponsored retirement plan having a participant account value comprises providing an option to a plan participant to elect lifetime payout funded by at least a portion of the participant's account value; providing an option to the participant to elect an excess period during which a participant maintains control over the portion of the account value; transferring the portion of the participant's account value into a group annuity contract; determining an initial benefit payment under the terms of the group annuity contract; determining a subsequent benefit payment; and paying the initial and subsequent payments to the participant. Other embodiments include one or more of these, and the step of determining a charge to be paid by the participant for the guaranteed lifetime payout.

Owner:LINCOLN NAT LIFE INSURANCE

System for and method of variable annuity contract administration

Owner:GUARDIAN LIFE INSURANCE COMPANY OF AMERICA

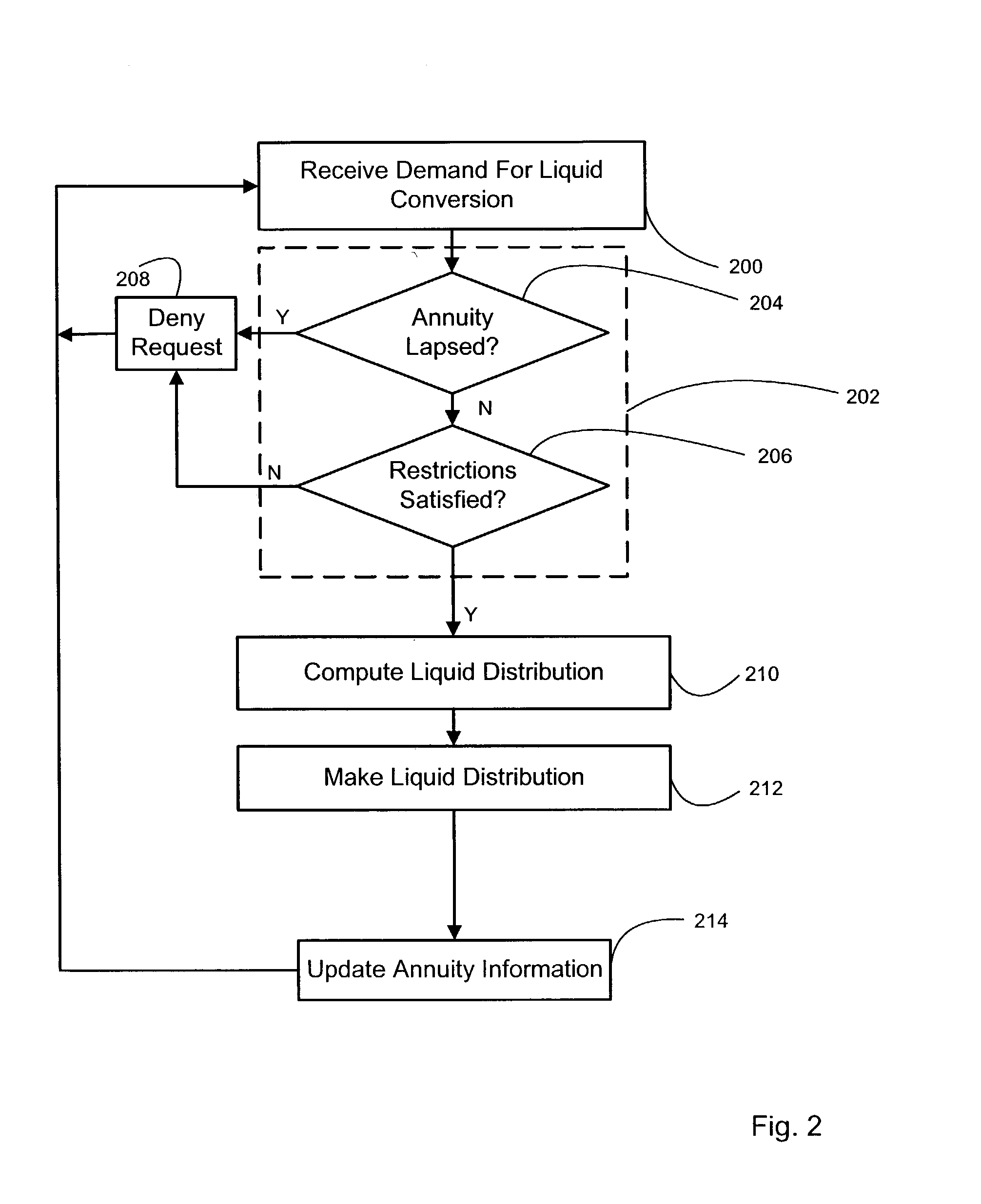

Methods and systems for providing liquidity options and permanent legacy benefits for annuities

This invention relates to methods and systems that provide annuities with at least one liquidity option that allows the holder of the liquidity option to exercise the option and convert therewith a portion of a value of the annuity into a liquid asset, such as cash or a cash value, based on the value of future income payments, which can include payments that are guaranteed to be paid for the duration of one or more lifetime. The conversion may be in a variety of forms, such as an advance of at least a portion of the future income payments, or in the form a lump sum distribution of at least a portion of a commuted value of the annuity computed based at least in part on the present value, at the time of the conversion, of future income payments for the remainder of the guarantee period. This invention further relates to methods and systems that provide annuities including a liquid legacy benefit option that provide a lump sum distribution of a portion of an annuity premium to a beneficiary at the end of the guarantee period that is substantially certain at the inception of the annuity.

Owner:NEW YORK LIFE INSURANCE COMPANY

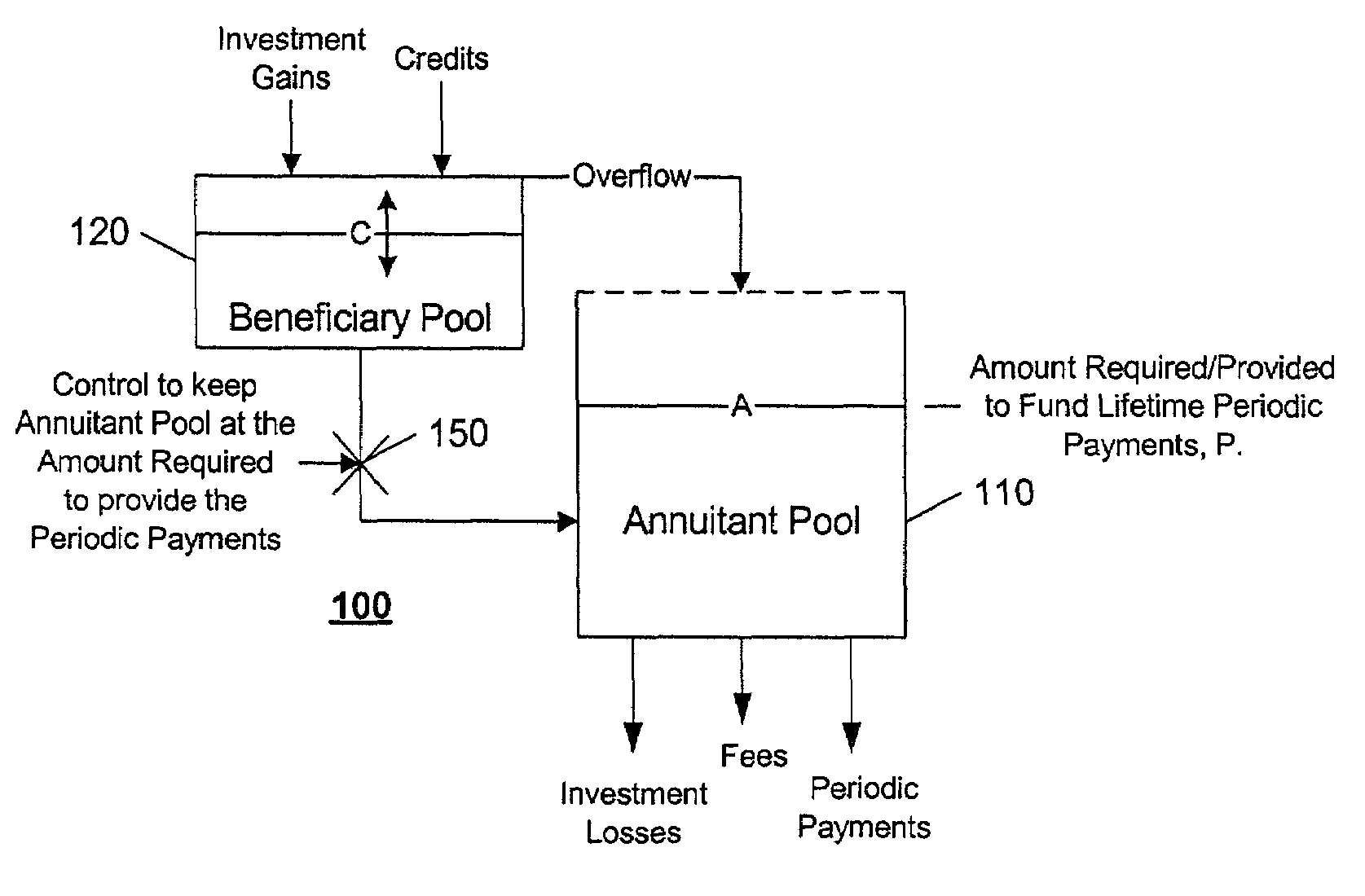

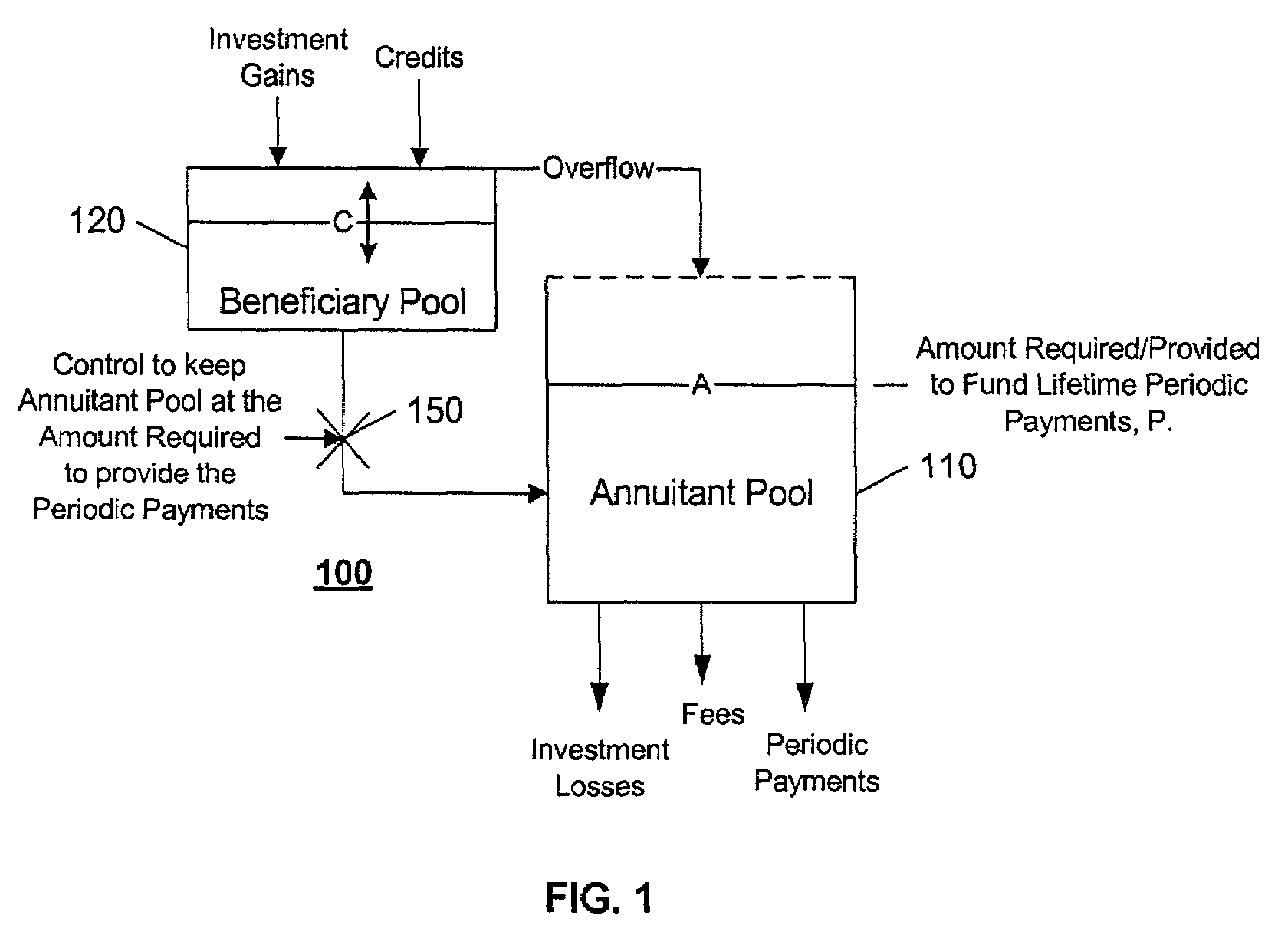

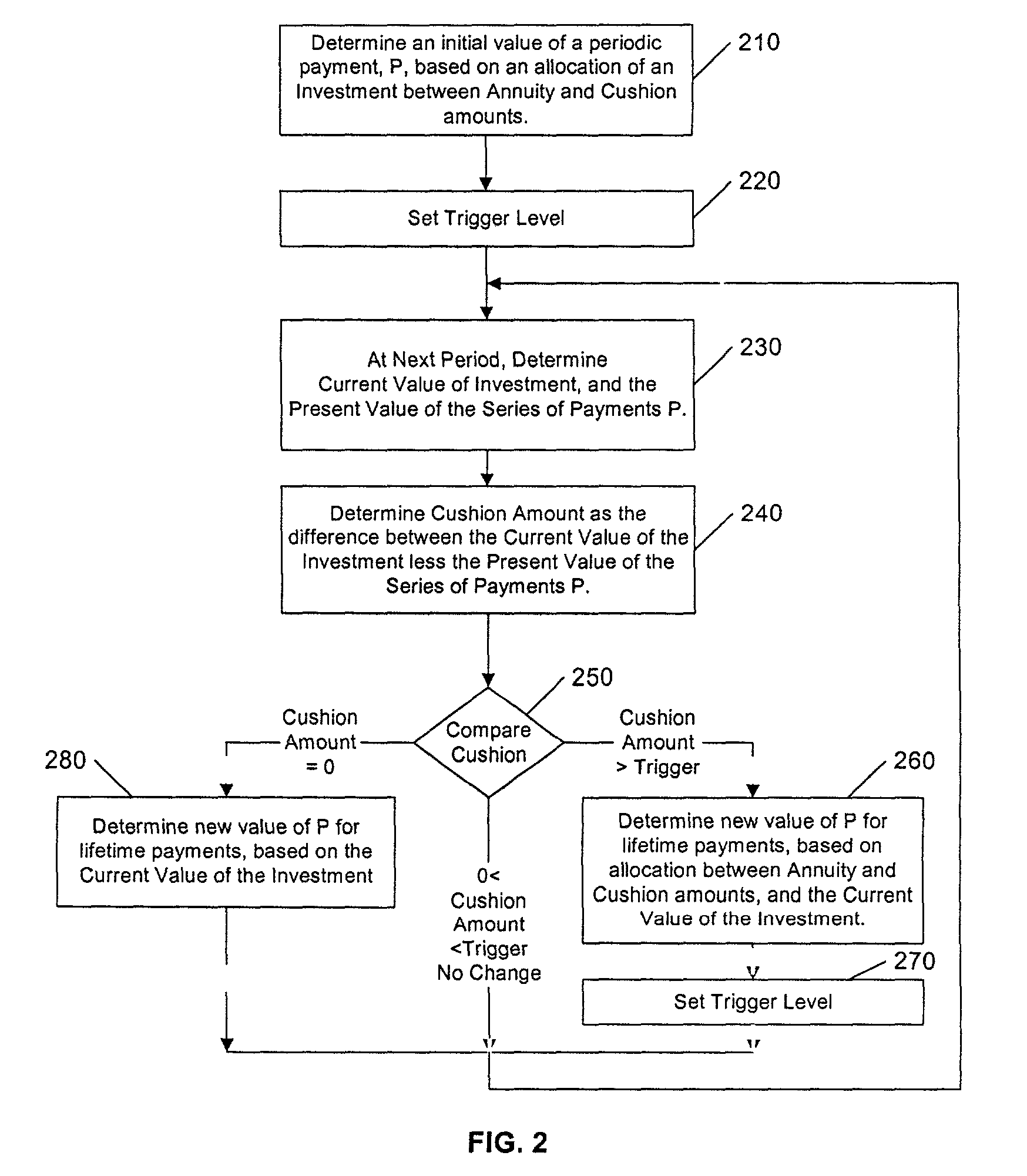

System, method, and computer program product for providing stabilized annuity payments and control of investments in a variable annuity

ActiveUS7401037B2Cushion against market volatilityThe total amount is stableFinanceAnnuityComputer science

In one embodiment, a method of managing assets for stabilizing anticipated periodic payments, allocating the assets to first and second pools; at periodic intervals, comparing the current value of the assets in the first pool to a present value of the remaining payments; and, when the current value is less the present value, reallocating a portion of the assets from the second pool to the first pool so that the first asset pool has a current value representing the present value. In another embodiment, a method for managing assets for stabilizing anticipated periodic payments includes allocating the assets into first and second pools; establishing a first payment amount; determining a first trigger value; assessing a current value of the assets; and reallocating assets from the second pool to the first pool to increase the first payment amount in response to the current value being greater than the first trigger value.

Owner:PRUDENTIAL INSURANCE OF AMERICA

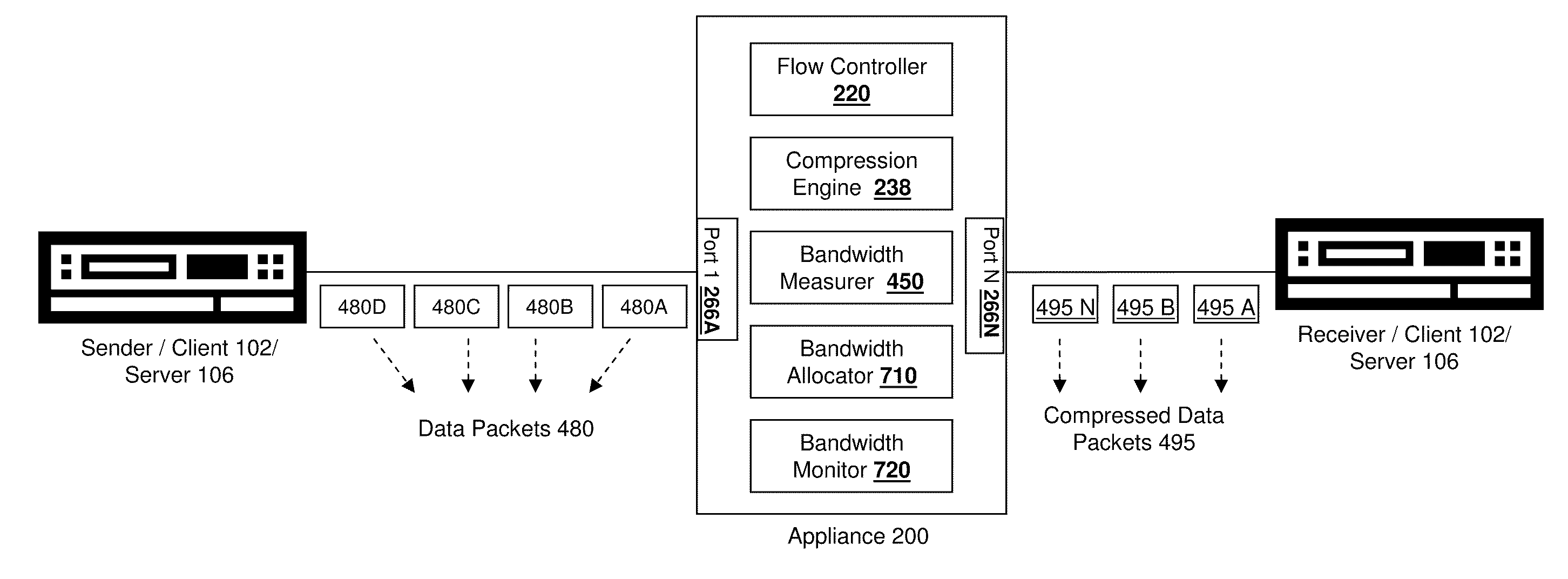

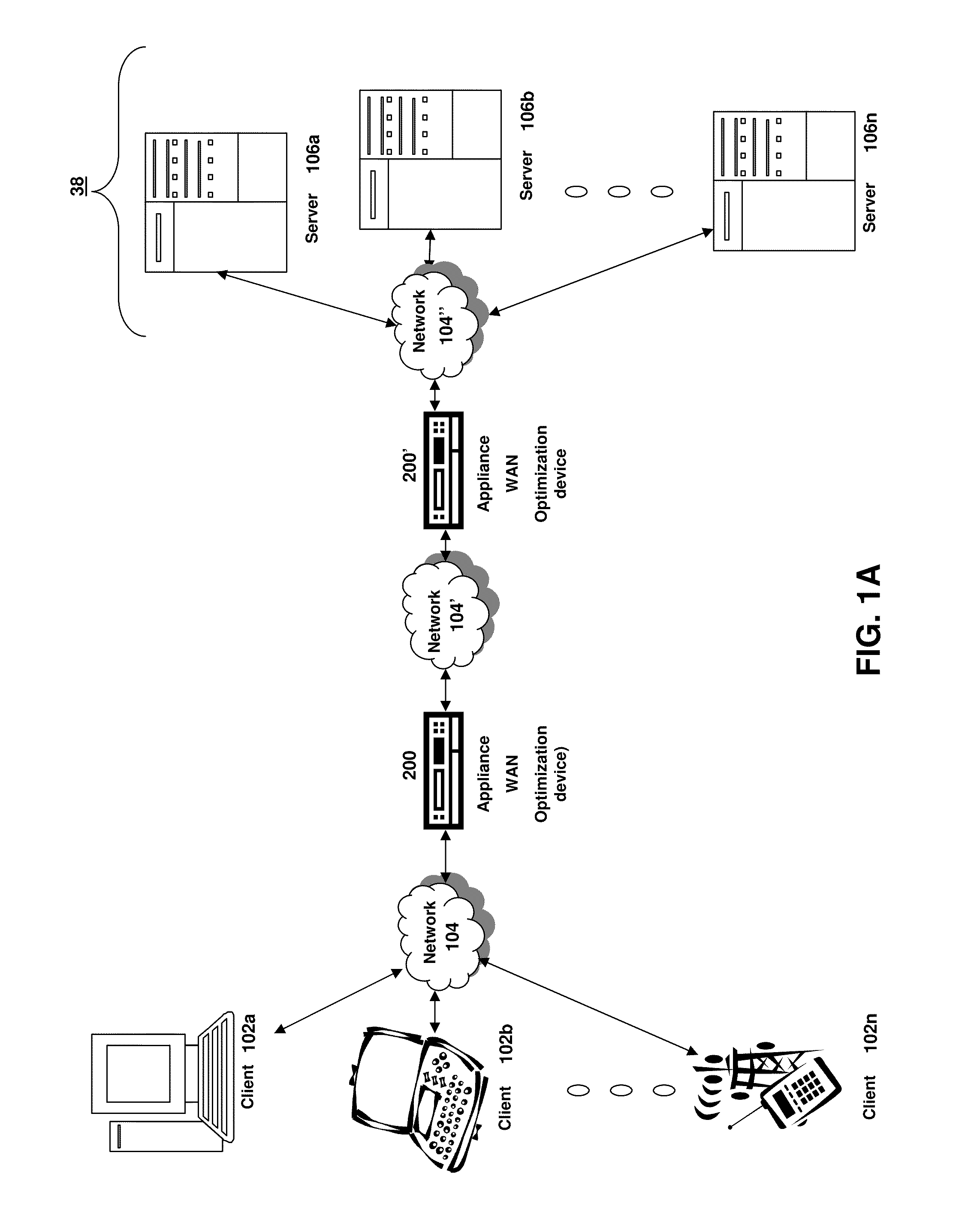

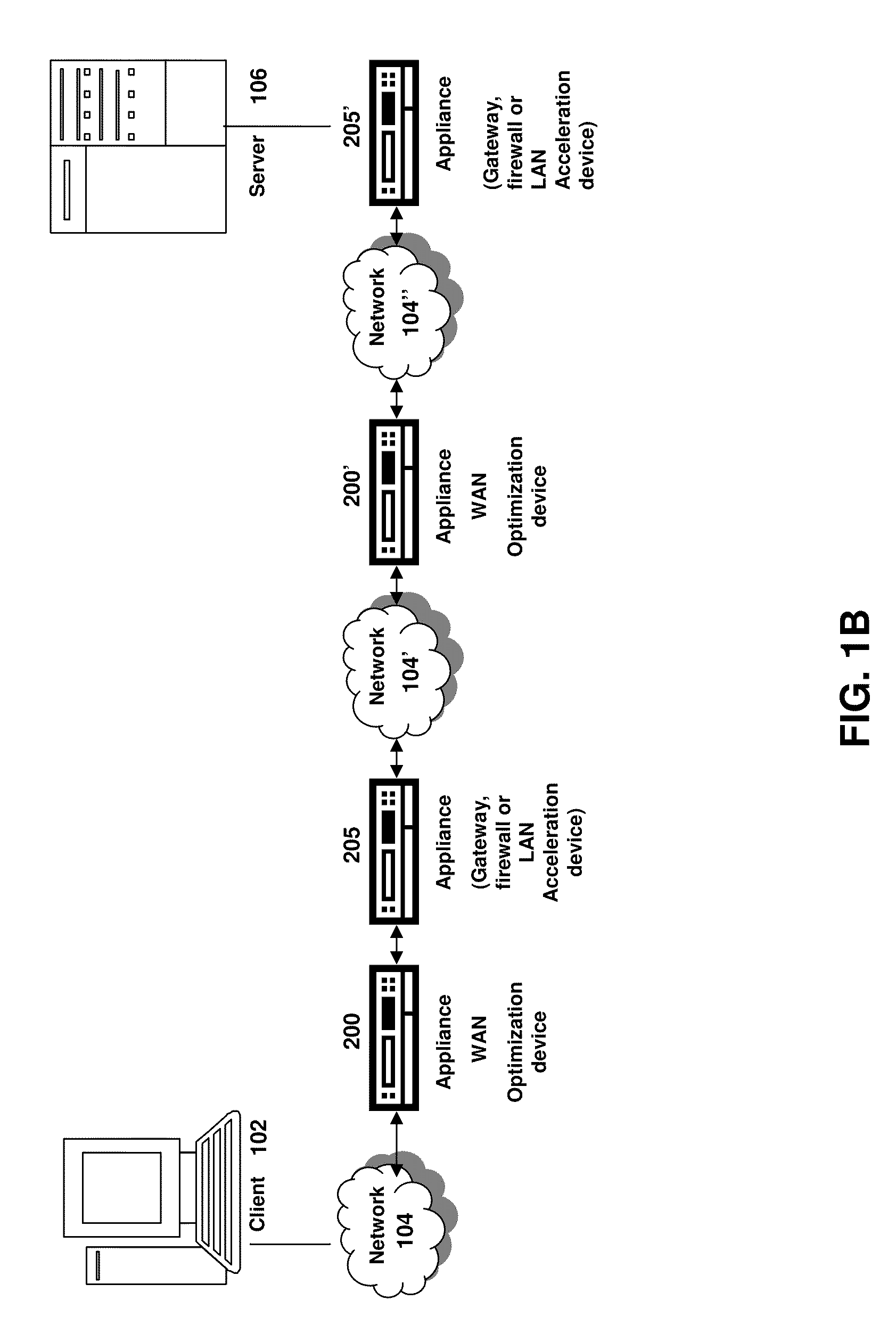

Systems and methods for allocating bandwidth by an intermediary for flow control

ActiveUS20100095021A1Efficient data flow controlEffective controlMultiple digital computer combinationsData switching networksAnnuityComputer science

The present disclosure is directed towards systems and methods for allocating a bandwidth credit or an annuity of bandwidth credit to a sender by an intermediary deployed between the sender and a receiver. The sender may be allocated a bandwidth credit or an annuity of bandwidth credit which may identify an amount of data the sender may transmit over a predetermined time period to the receiver, via the intermediary. The intermediary may determine an allocation of a one-time bandwidth credit based on the determination that a difference between the rate of transmission of the sender and the bandwidth usage of the sender falls below a predetermined threshold of the bandwidth credit. The intermediary may determine an annuity of bandwidth credit based on a determination that a difference between the bandwidth usage of the sender over the annuity period and the annuity of bandwidth credit exceeds a predetermined threshold.

Owner:CITRIX SYST INC

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com