Annuity Having Interest Rate Coupled to a Referenced Interest Rate

a technology of referenced interest rate and annuity, which is applied in the field of annuity and a management method of annuity, can solve the problems of reducing the value of fixed annuities, affecting the investment prospects of contract holders, and reducing the value of variable annuities

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

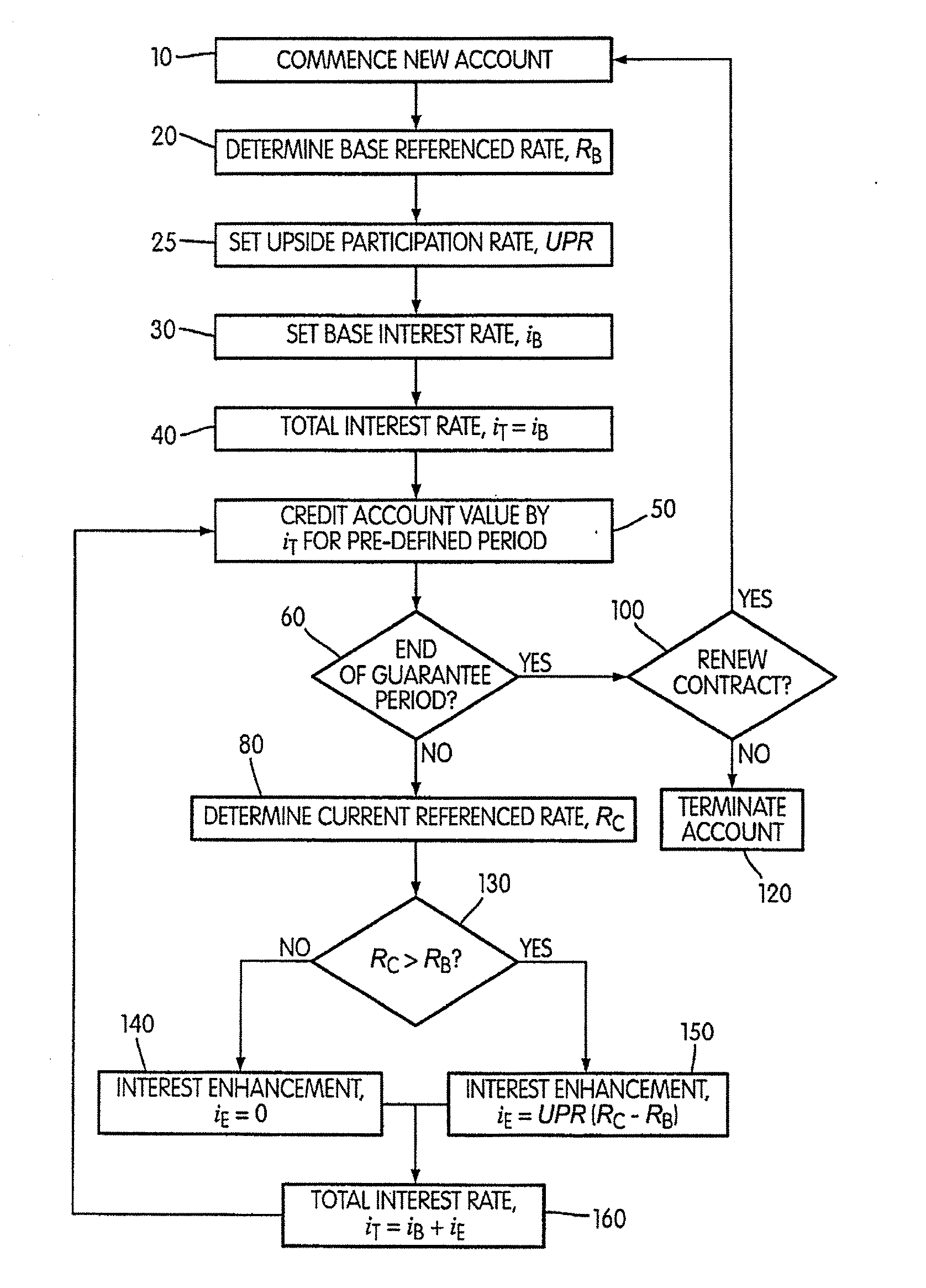

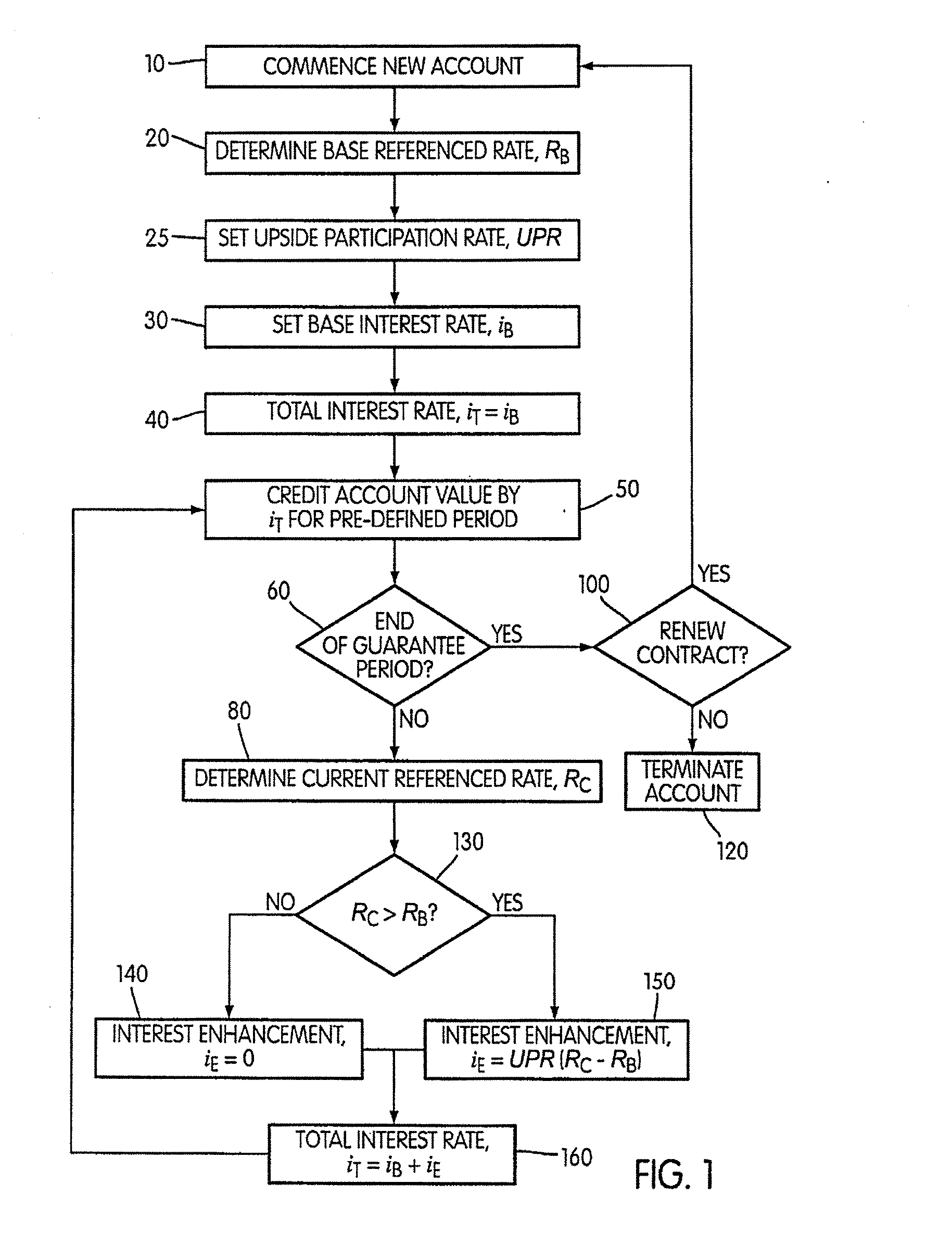

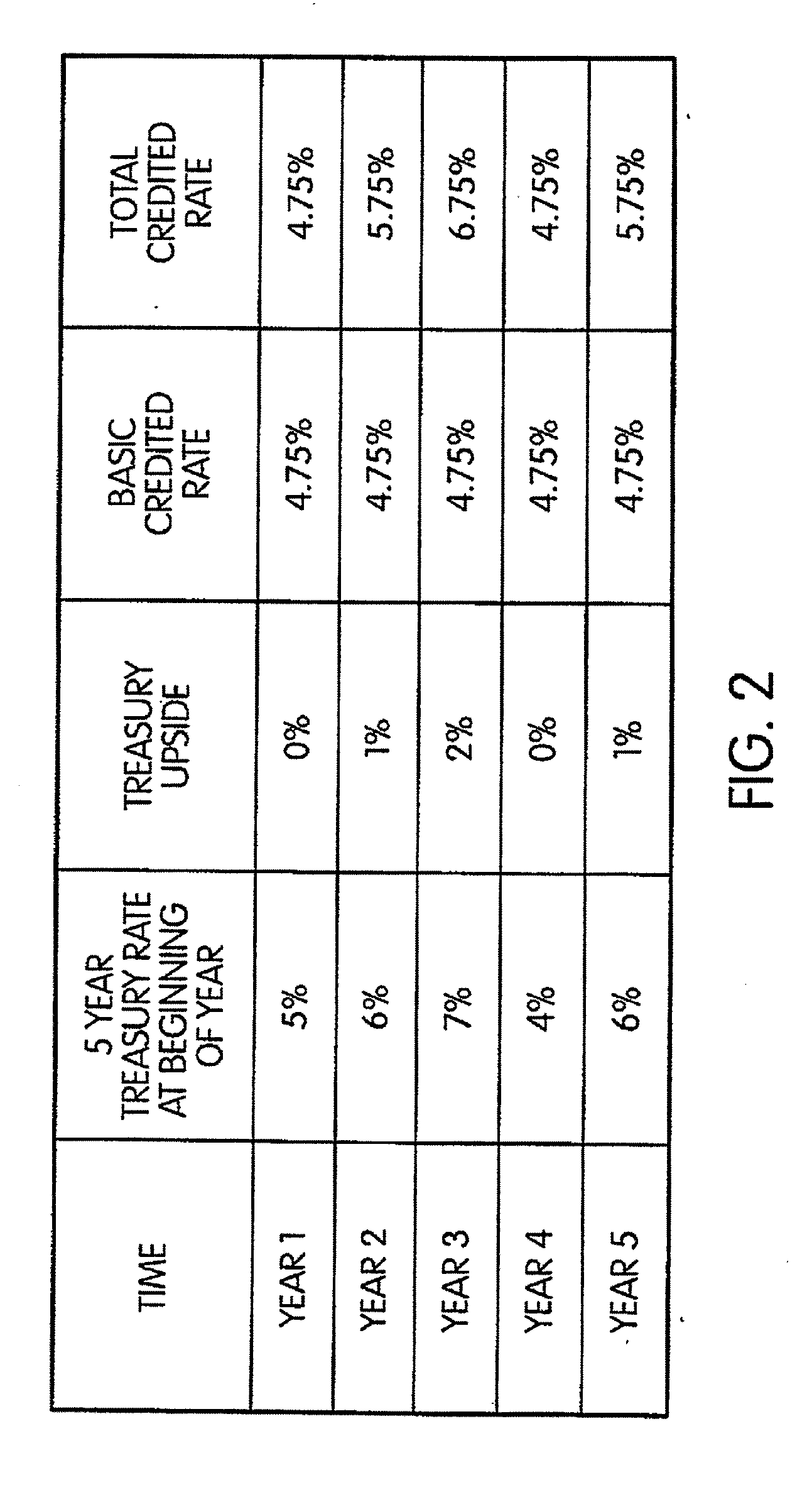

[0018] Management of the annuity contract of the present invention is schematically illustrated in FIG. 1. The annuity contract may be purchased from an authorized agent for an initial contribution (known as a purchase payment). The contract preferably has a specified time duration (known as the guarantee period) which most preferably is five years from the date of initial purchase.

[0019] The contract preferably guarantees a competitive fixed interest rate plus participation in upward movements in a specified referenced interest rate, such as a specified Treasury rate, after issue. The customer value in this is that they don't lock into a fixed rate investment that pays a relatively low rate of return for many years.

[0020] The crediting formula for growth of the annuity account is preferably defined as a rolling base interest rate (iB) guaranteed for a specified duration, preferably five years, although other specified durations could be defined. As indicated, the base interest ra...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com