Patents

Literature

234 results about "Price prediction" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

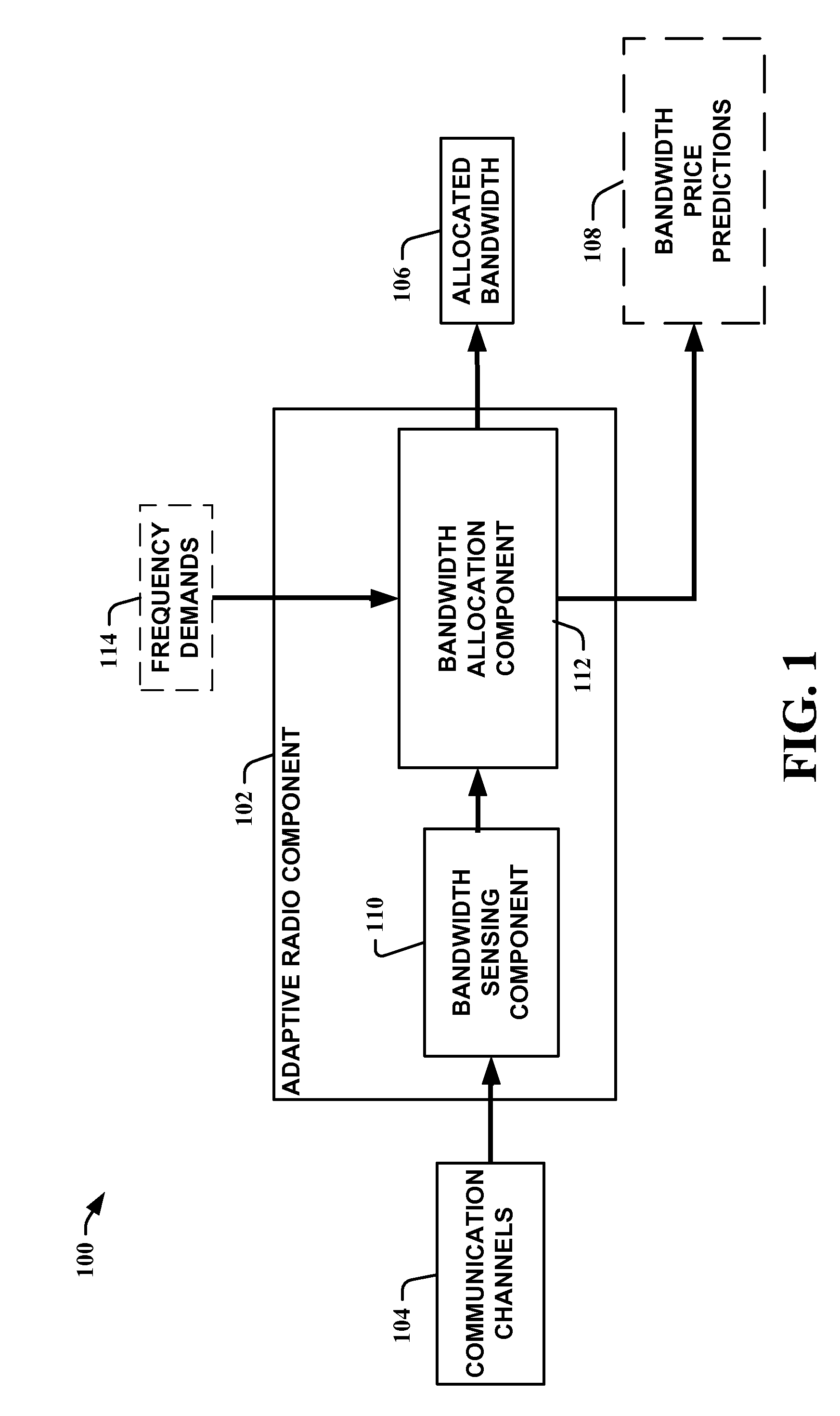

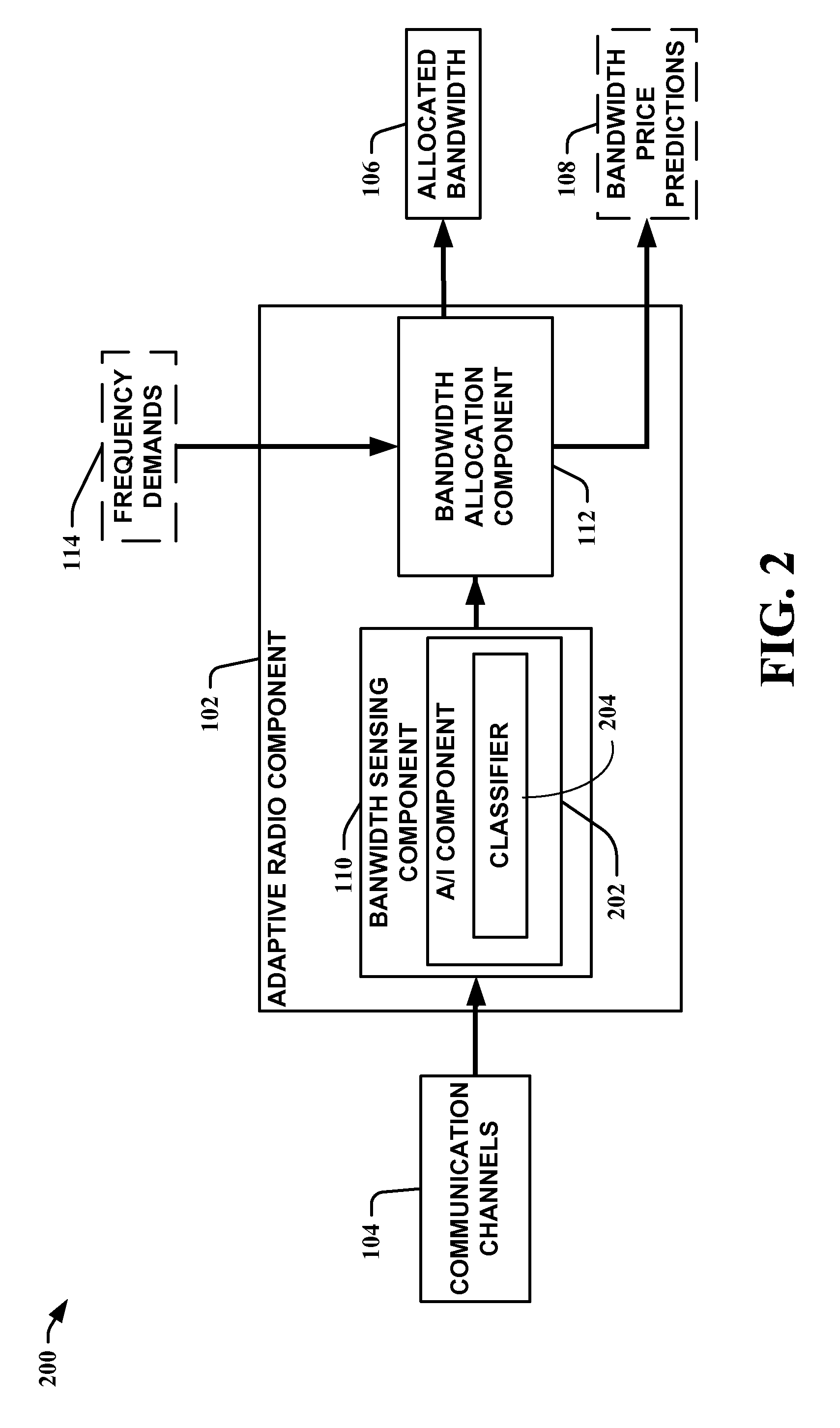

Harnessing predictive models of durations of channel availability for enhanced opportunistic allocation of radio spectrum

ActiveUS8254393B2Minimize disruptionMinimizing glitchError preventionFrequency-division multiplex detailsFrequency spectrumCost–benefit analysis

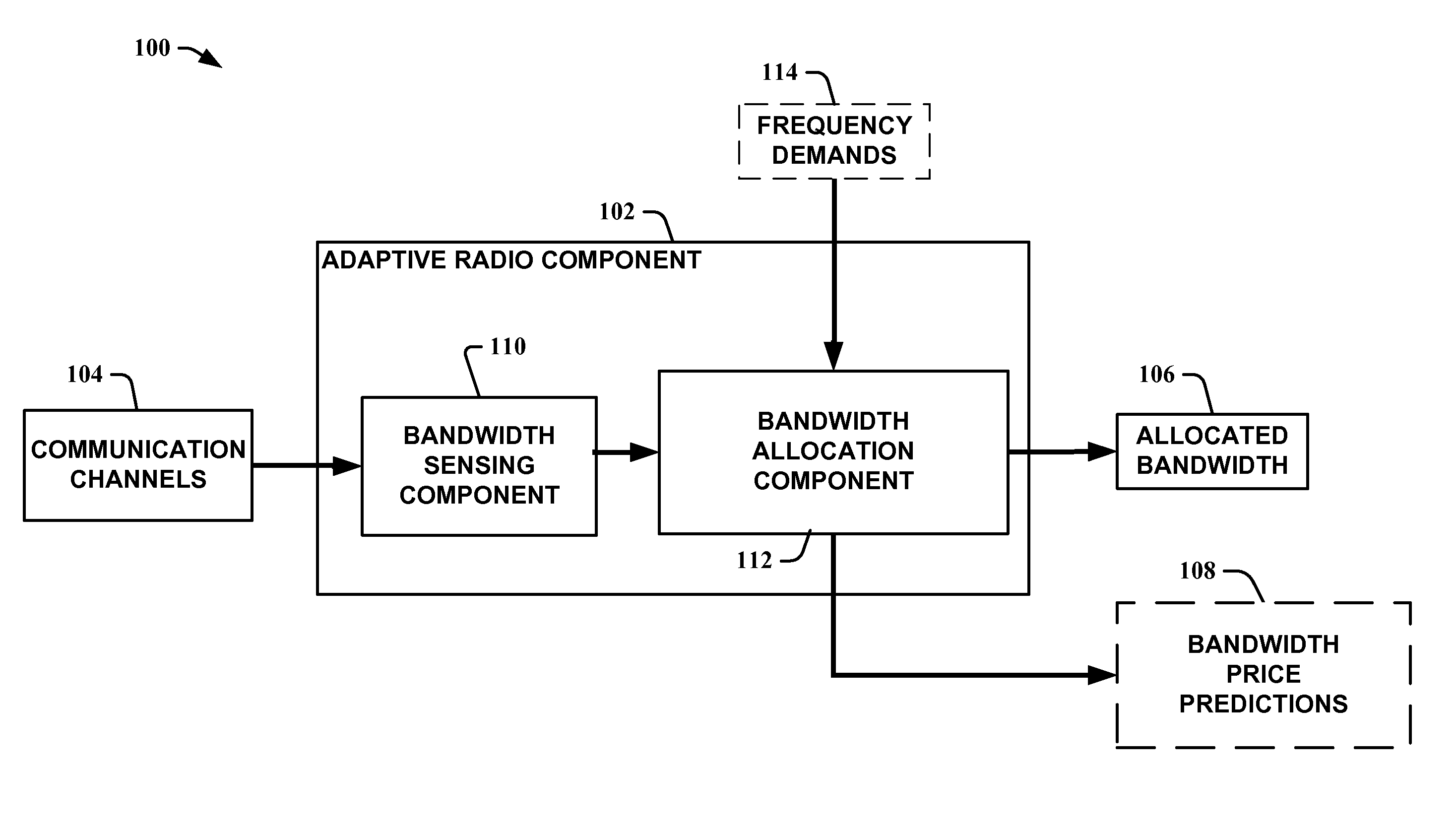

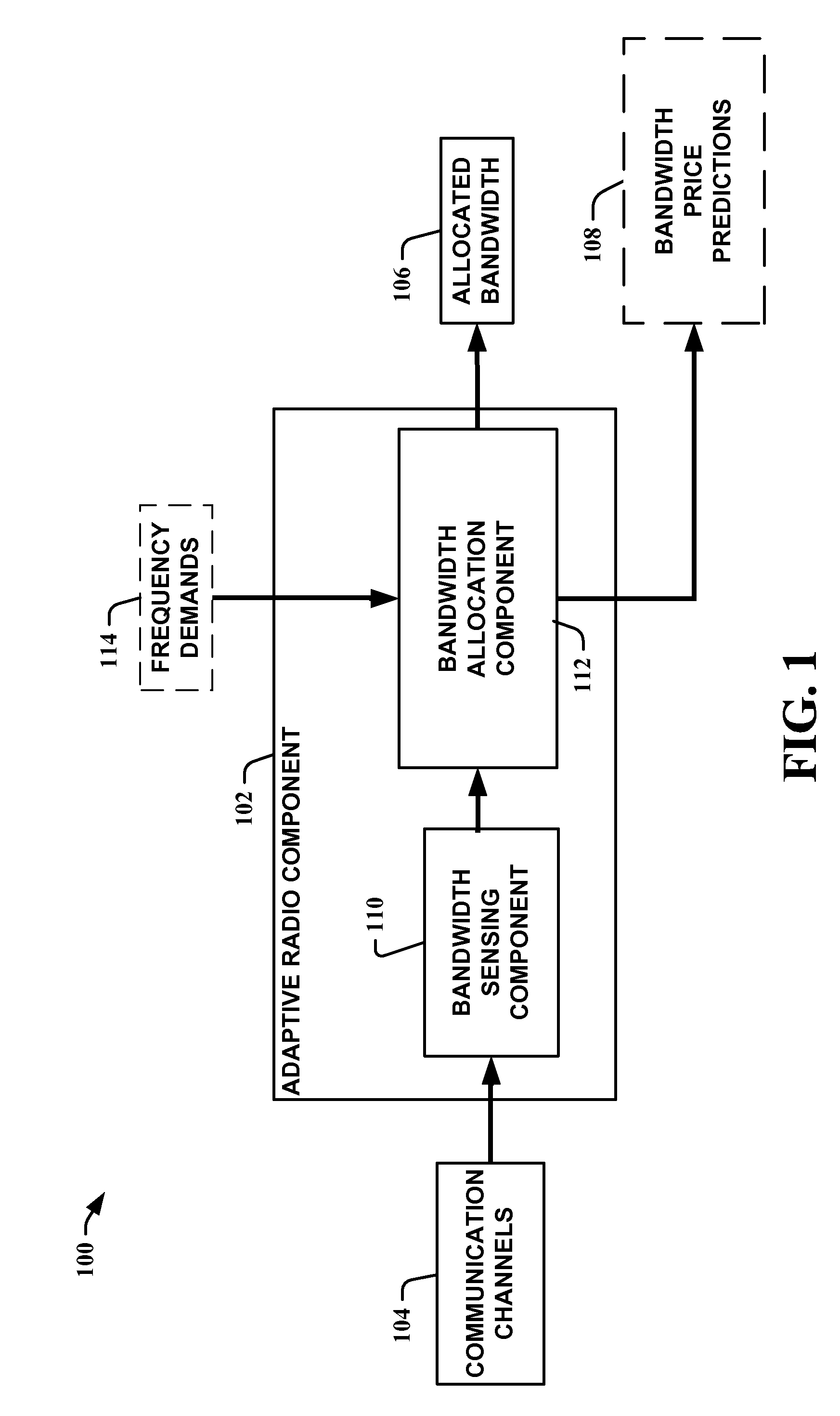

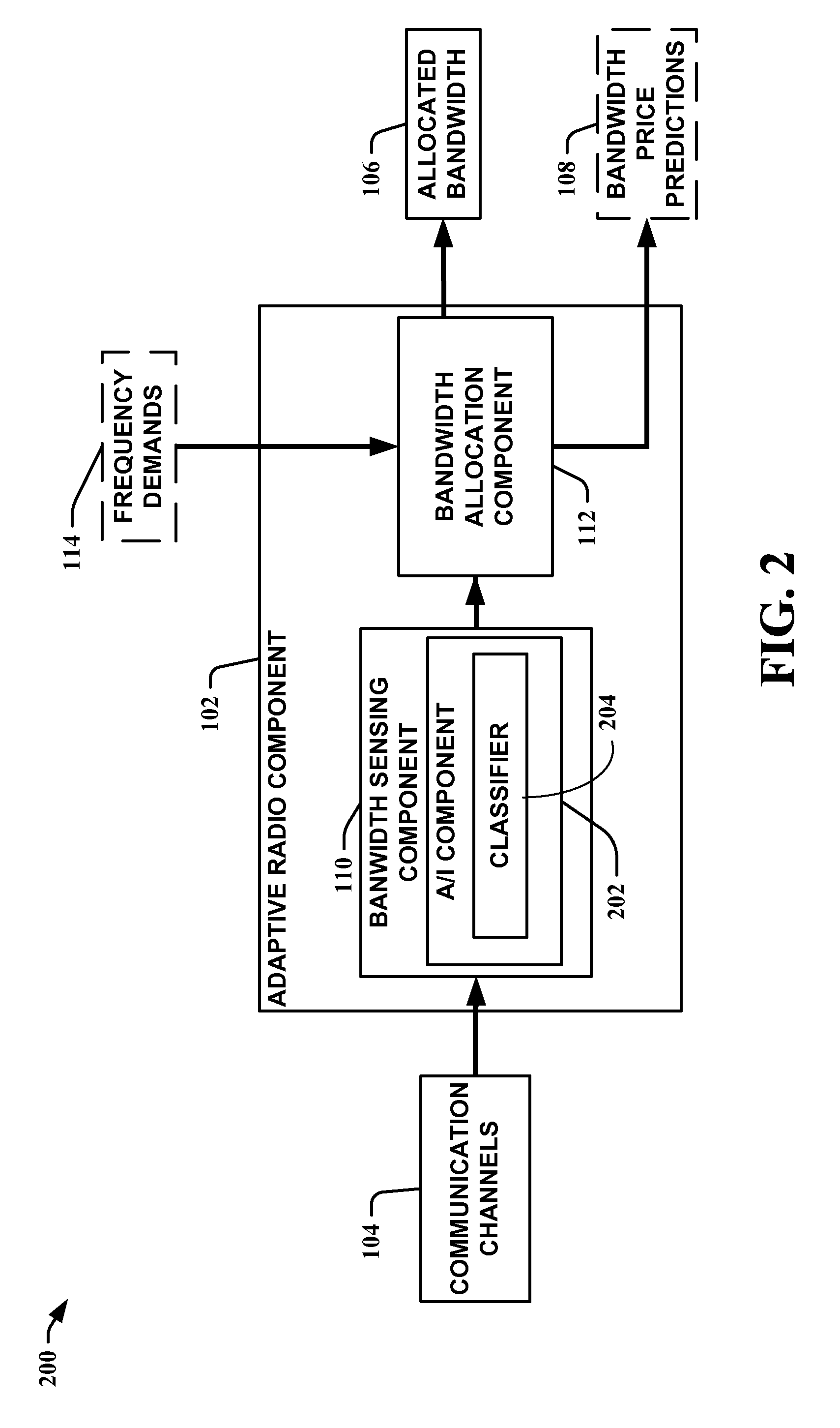

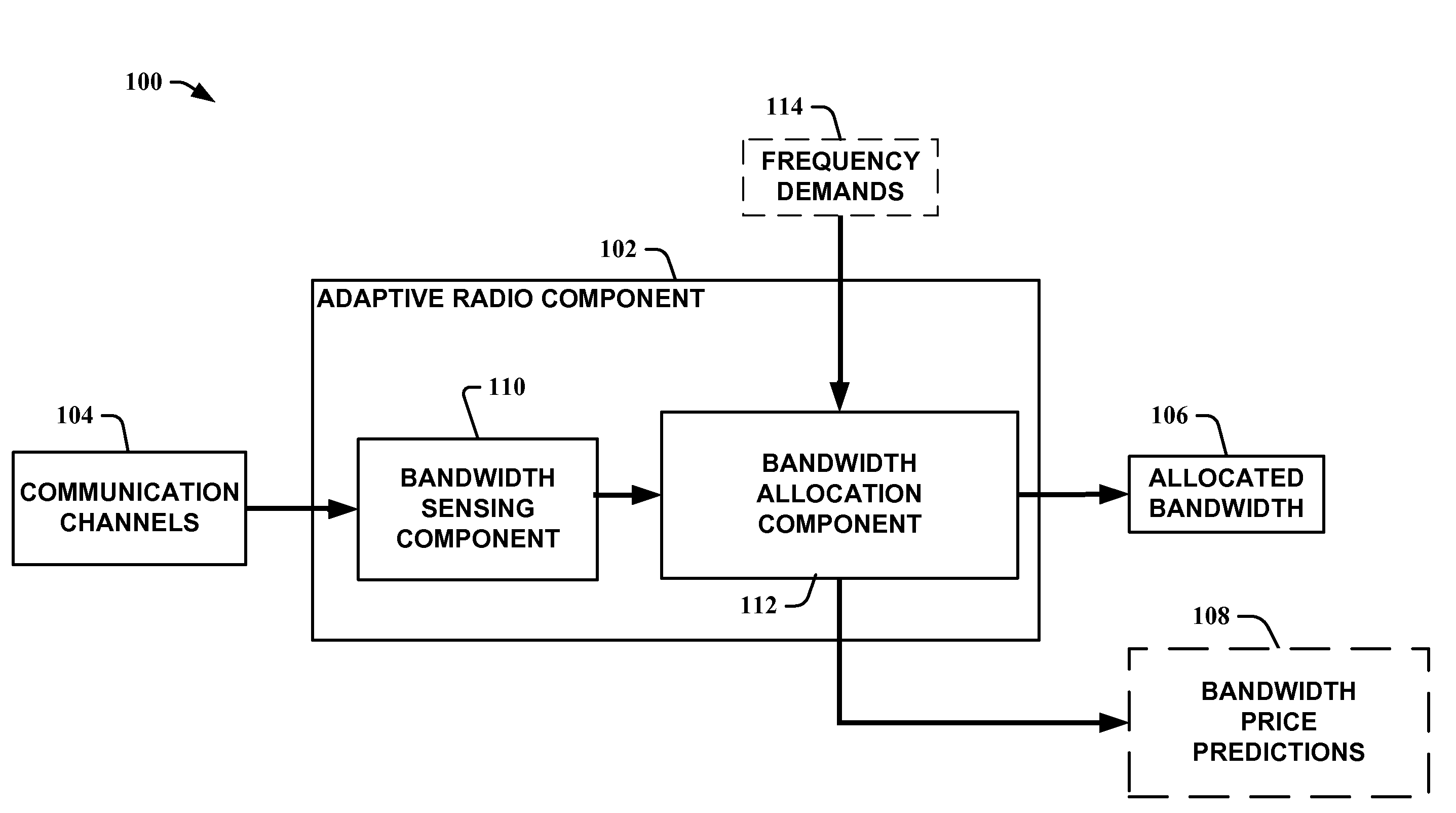

A proactive adaptive radio methodology for the opportunistic allocation of radio spectrum is described. The methods can be used to allocate radio spectrum resources by employing machine learning to learn models, via accruing data over time, that have the ability to predict the context-sensitive durations of the availability of channels. The predictive models are combined with decision-theoretic cost-benefit analyses to minimize disruptions of service or quality that can be associated with reactive allocation policies. Rather than reacting to losses of channel, the proactive policies seek switches in advance of the loss of a channel. Beyond determining durations of availability for one or more frequency bands statistical machine learning also be employed to generate price predictions in order to facilitate a sale or rental of the available frequencies, and these predictions can be employed in the switching analyses The methods can be employed in non-cooperating distributed models of allocation, in centralized allocation approaches, and in hybrid spectrum allocation scenarios.

Owner:MICROSOFT TECH LICENSING LLC

Harnessing predictive models of durations of channel availability for enhanced opportunistic allocation of radio spectrum

ActiveUS20090003201A1Minimizing glitchMinimize disruptionError preventionFrequency-division multiplex detailsFrequency spectrumCost–benefit analysis

A proactive adaptive radio methodology for the opportunistic allocation of radio spectrum is described. The methods can be used to allocate radio spectrum resources by employing machine learning to learn models, via accruing data over time, that have the ability to predict the context-sensitive durations of the availability of channels. The predictive models are combined with decision-theoretic cost-benefit analyses to minimize disruptions of service or quality that can be associated with reactive allocation policies. Rather than reacting to losses of channel, the proactive policies seek switches in advance of the loss of a channel. Beyond determining durations of availability for one or more frequency bands statistical machine learning also be employed to generate price predictions in order to facilitate a sale or rental of the available frequencies, and these predictions can be employed in the switching analyses The methods can be employed in non-cooperating distributed models of allocation, in centralized allocation approaches, and in hybrid spectrum allocation scenarios.

Owner:MICROSOFT TECH LICENSING LLC

Stock ranking & price prediction based on neighborhood model

A system and method of aggregating and ranking stocks based on the earning capabilities of each stock. The novel system and method use a neighborhood model of pricing trend prediction to aggregate a plurality of “neighboring” or related stocks to predict pricing of one stock within the plurality of related stocks. The system facilitates investors trading stocks by using the novel methodology to rank the stocks and by having an easy-to-use interface.

Owner:FLORIDA STATE UNIV RES FOUND INC

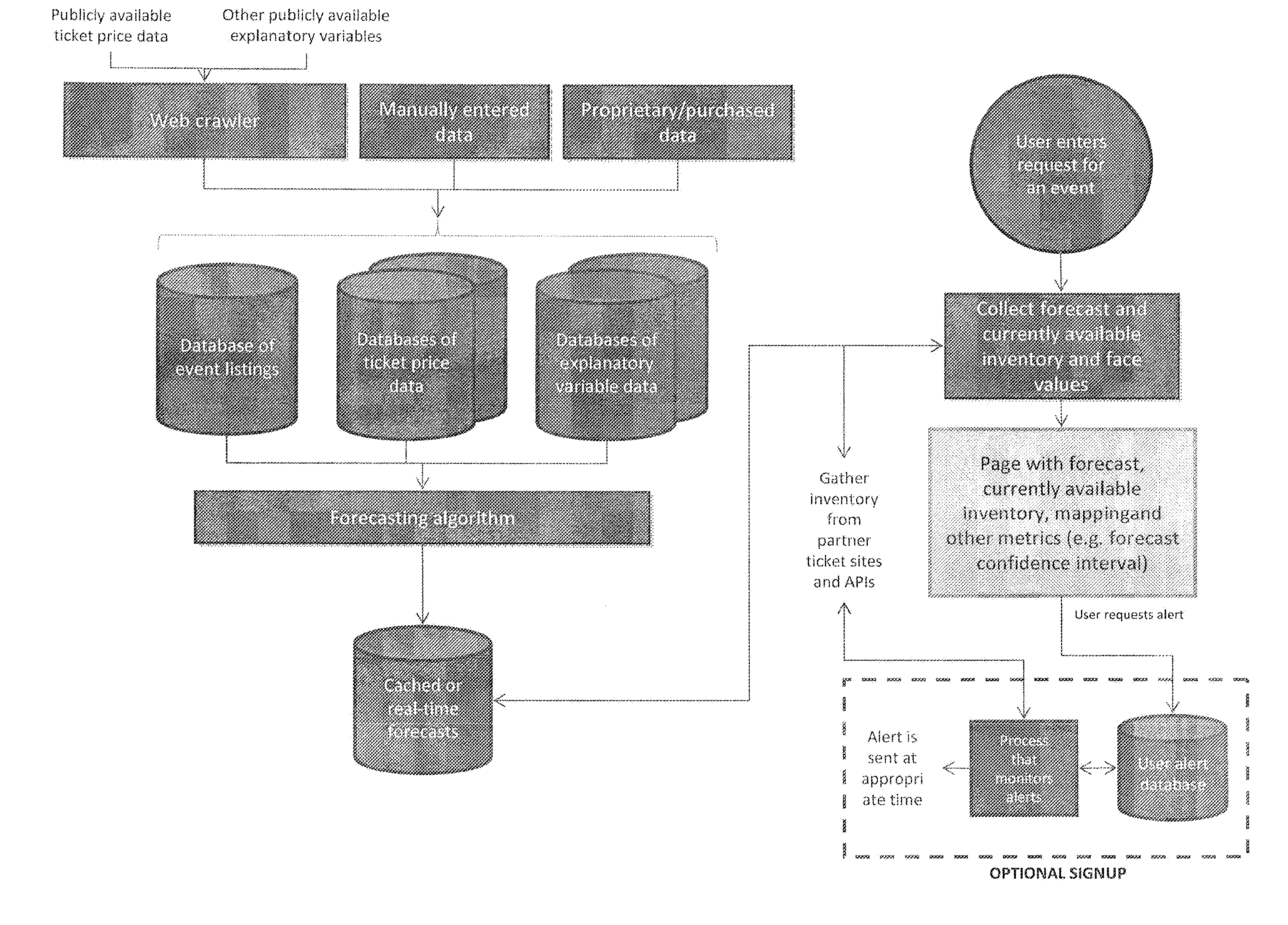

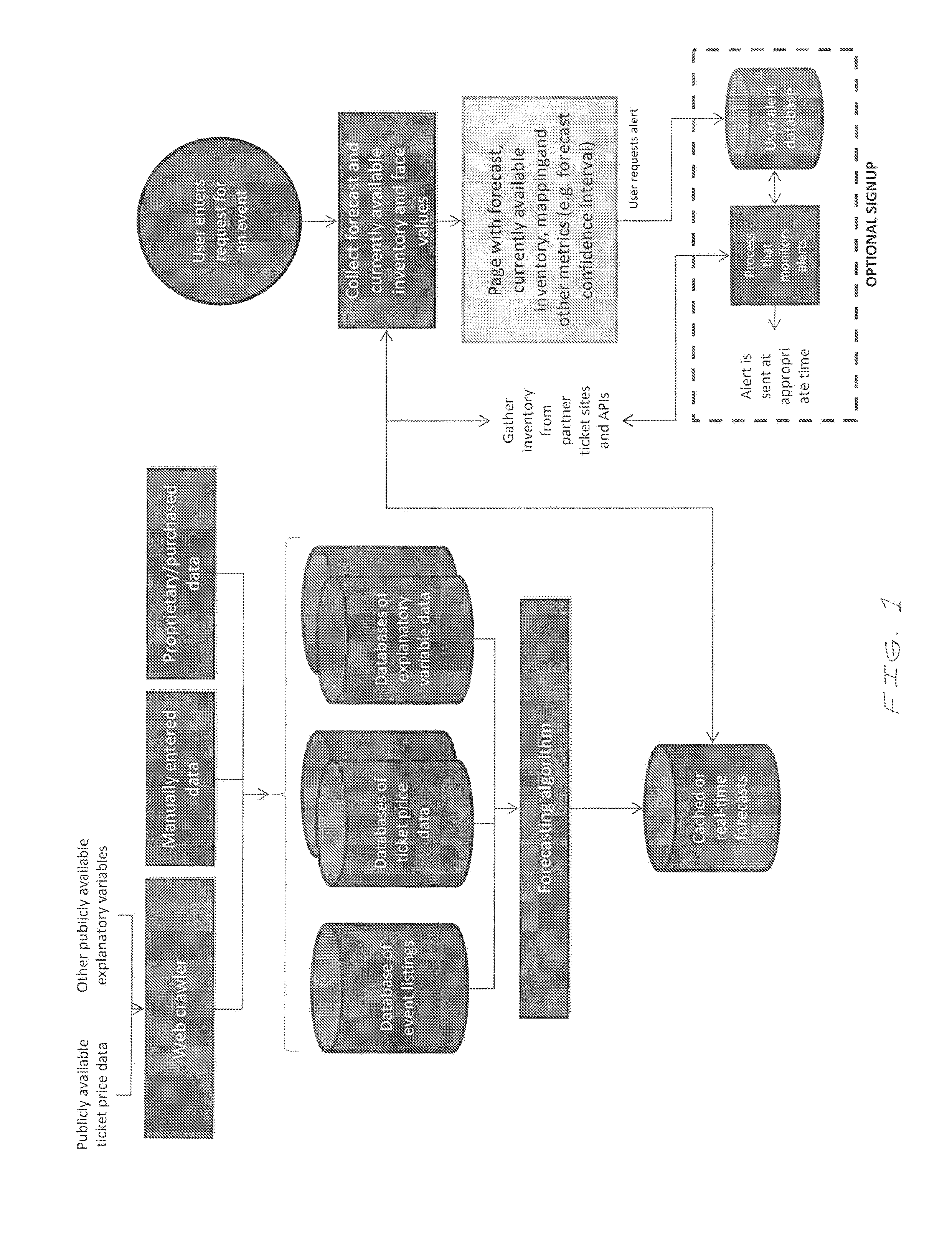

System and method for generating predictions of price and availability of event tickets on secondary markets

InactiveUS20110040656A1Purchase price is minimizedSelling price is maximizedProduct appraisalSelf trainingPrice prediction

A system and method is provided for predicting future price and availability of event tickets on the primary and secondary market and providing buyers with a recommendation as to when to purchase the event tickets at the lowest possible cost or, for sellers, when to sell the tickets at the highest possible price. Data is collected and used to generate statistics about the historical price and availability of event tickets. This data is further used to provide forecasts about the future price and availability of event tickets, including the probability of a sell out for events currently on sale and events not yet on sale. The system makes predictions by differentially weighing factors, both economic and non-economic, that influence the price trajectory and availability of event tickets. The system further includes a self-training mechanism that evolves behaviors based on previous price predictions thereby increasing the systems ability to accurately predict future event ticket prices.

Owner:SEATGEEK

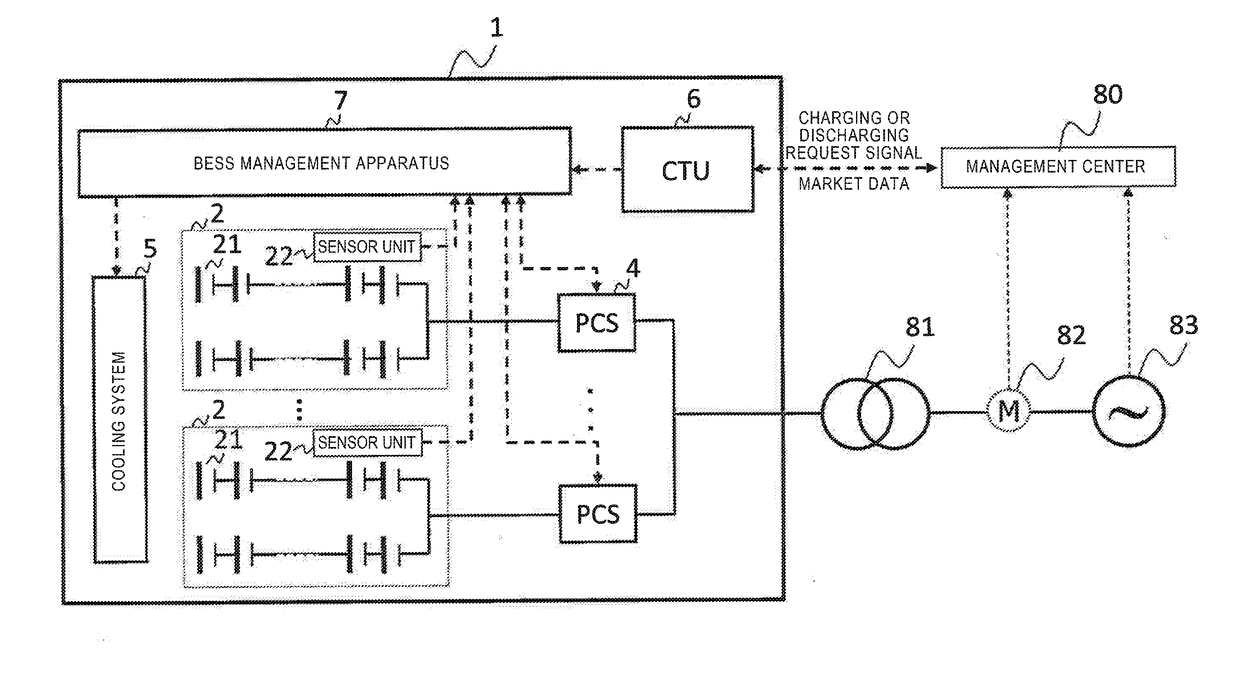

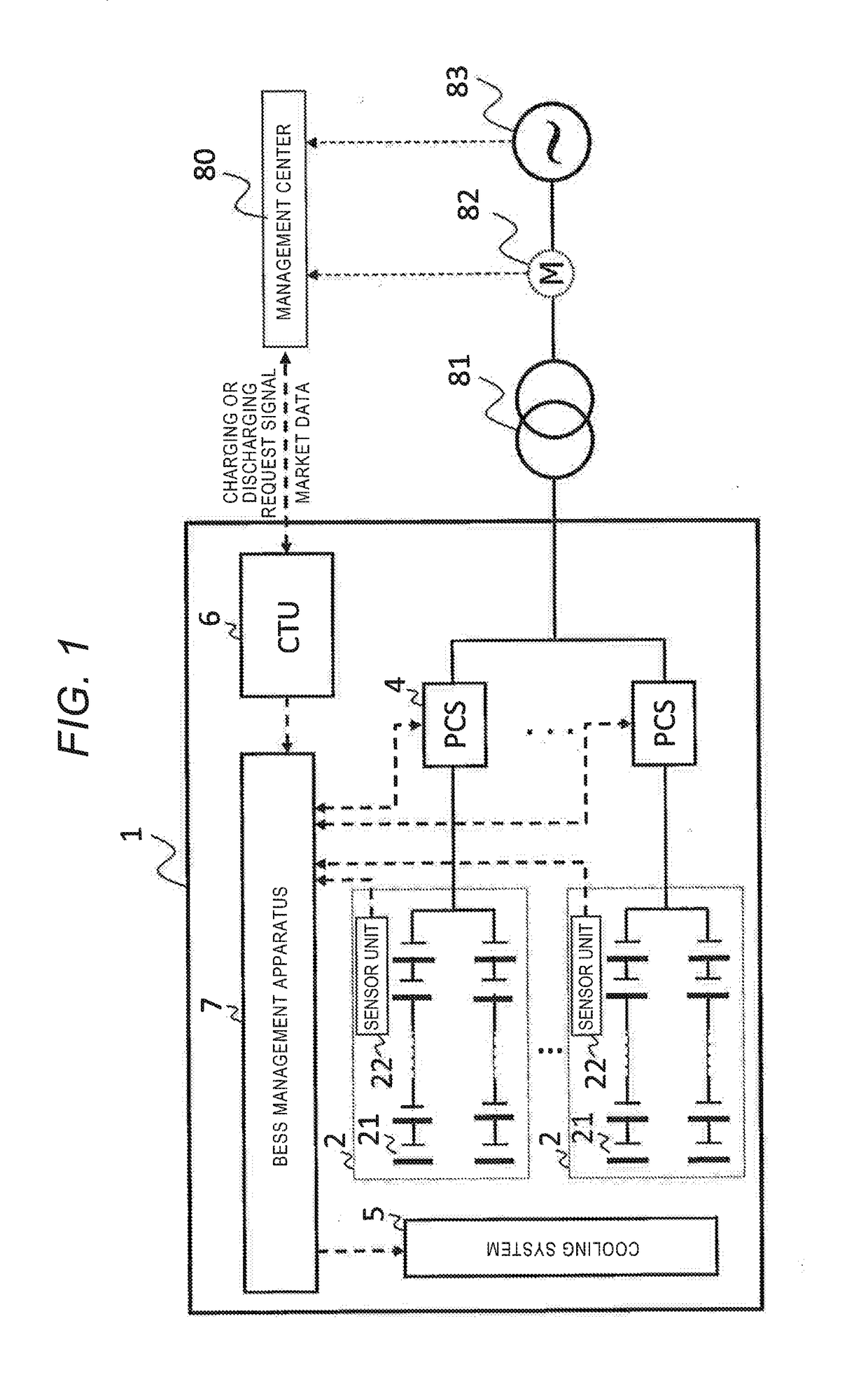

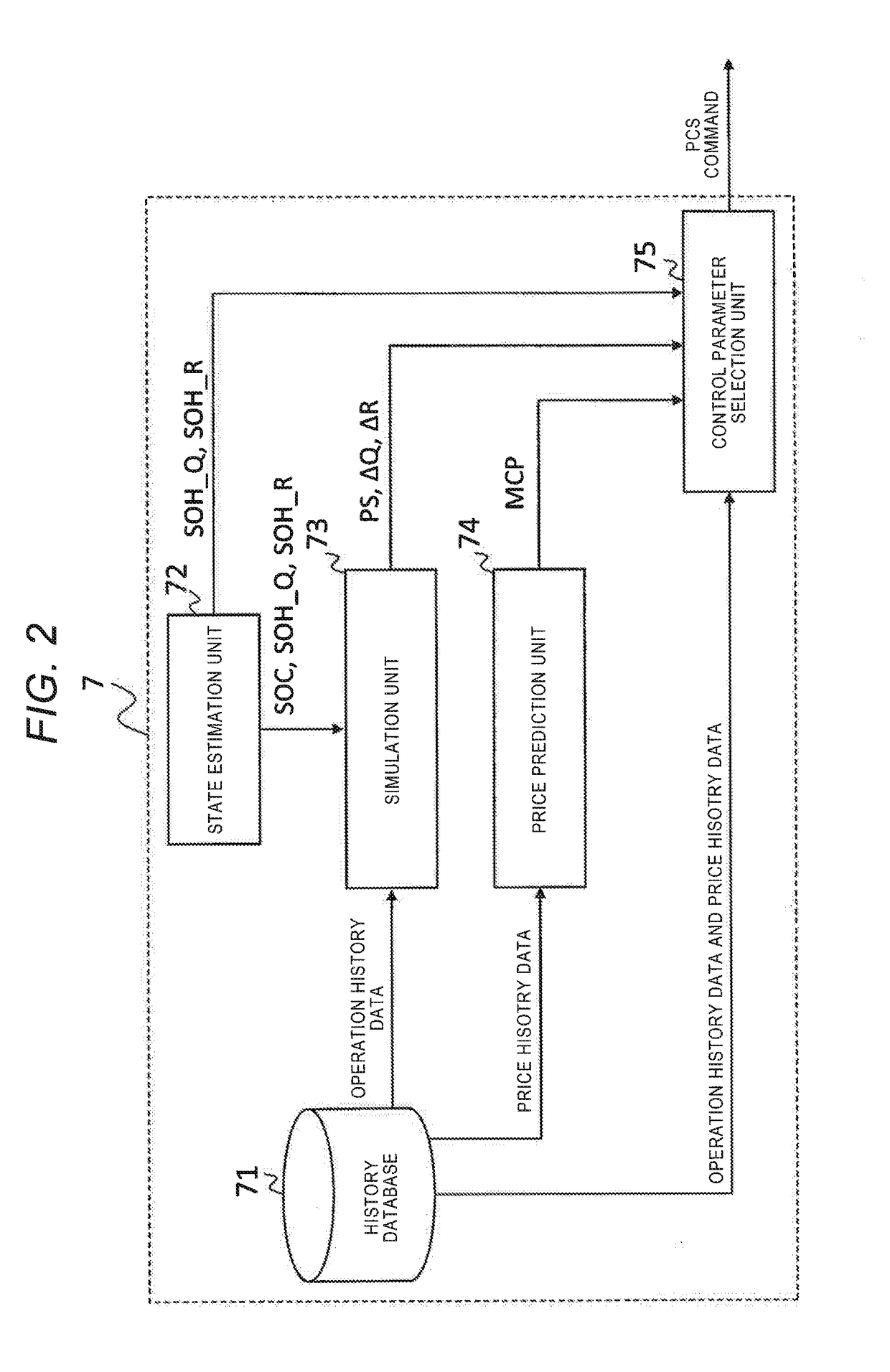

Battery Energy Storage System Management Apparatus, Battery Energy Storage System Management Method, and Battery Energy Storage System

InactiveUS20170170684A1Flexible AC transmissionCircuit monitoring/indicationElectrical batteryState of health

In a BESS management apparatus, a history database stores operation history data related to operation history of a BESS and price history data related to price history of a service. A state estimation unit estimates a state of charge and a state of health of a battery. A simulation unit calculates a performance score of the BESS with respect to providing of the service based on the operation history data stored in the history database and the state of charge and the state of health of the battery estimated by the state estimation unit. A price prediction unit calculates a predicted price of the service based on the price history data stored in the history database. A control parameter selection unit selects a control parameter for controlling an operation of the BESS based on the performance score and the predicted price.

Owner:HITACHI LTD

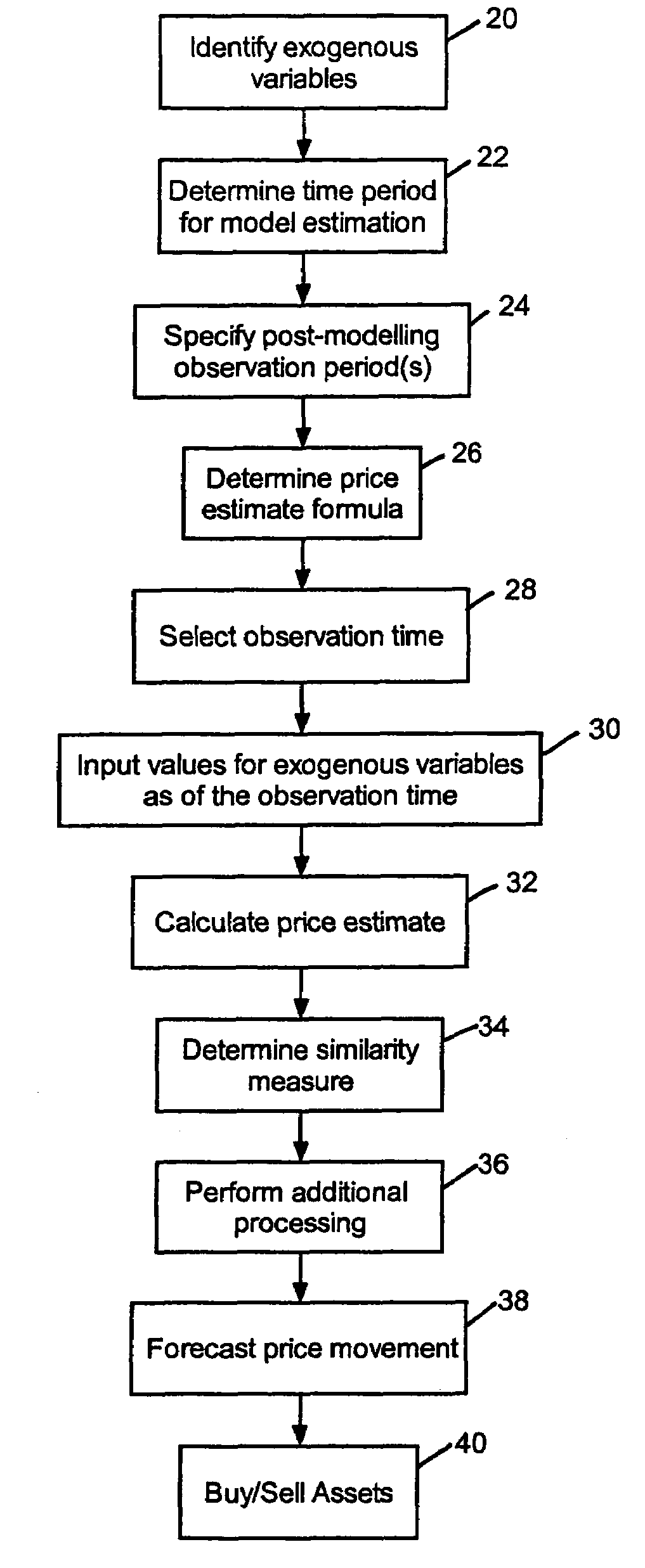

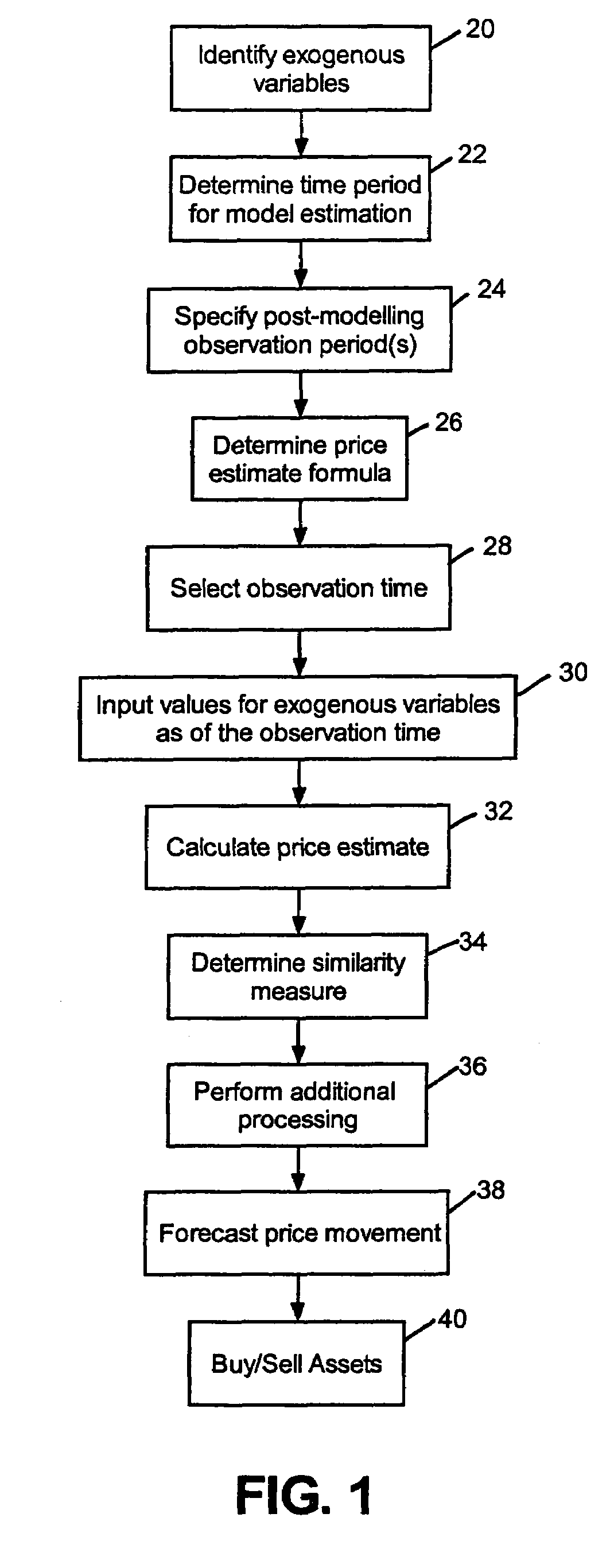

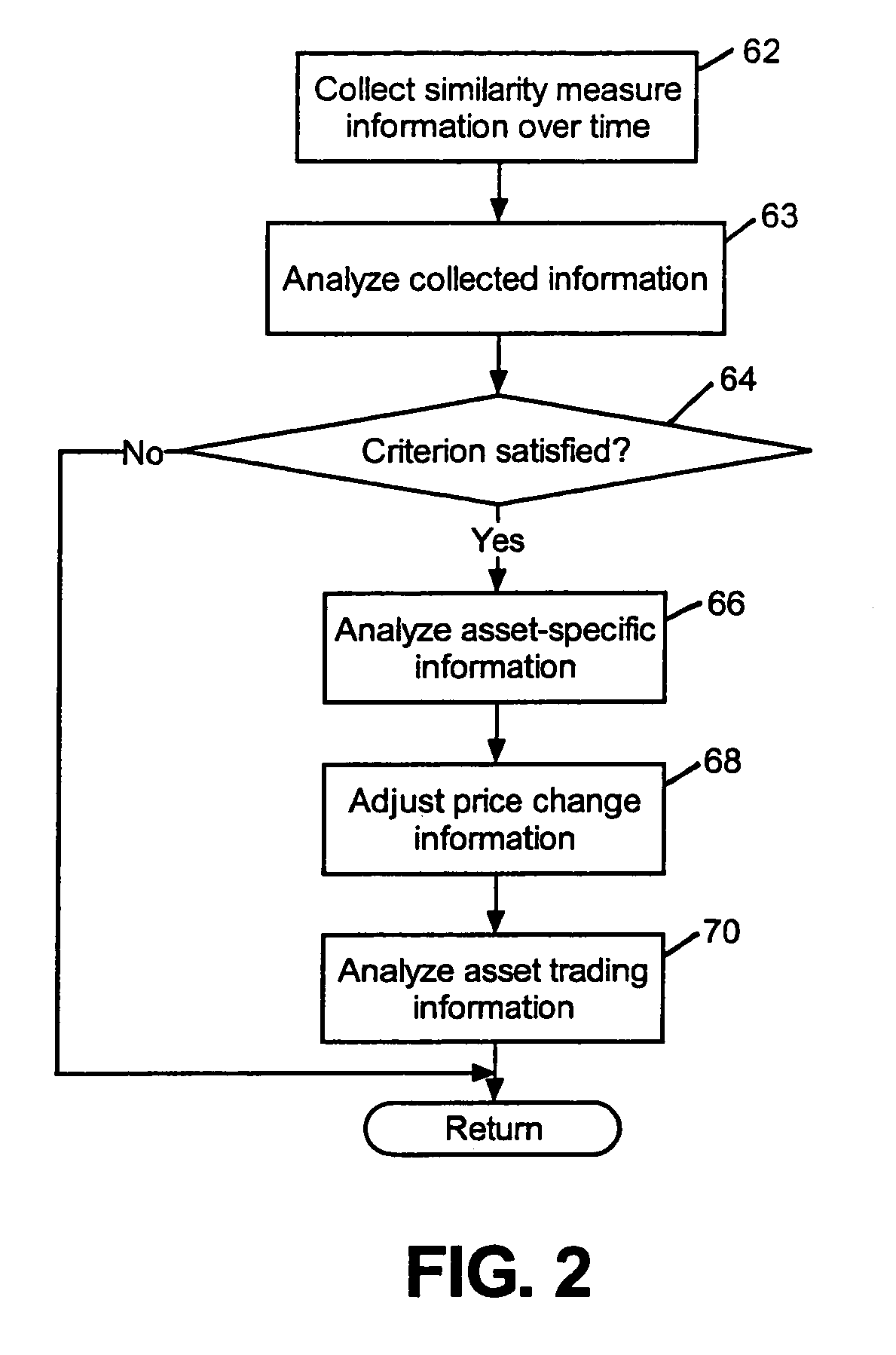

Asset price forecasting

Provided is a technique forecasting the direction in which the price of an asset will move by identifying a group of exogenous variables that are likely to influence observed prices of an asset. Then, historical data for values of the exogenous variables and historical data for the observed prices of the asset over a time period are processed to obtain a formula for calculating price estimates for the asset as a function of the exogenous variables. The formula is calculated using an input set of observed values for the exogenous variables at given point in time, so as to obtain a price estimate for the asset at the given point in time. Then, a similarity measure is determined by comparing the price estimate for the asset at the given point in time to the observed price for the asset at the given point in time. Finally, a direction in which the observed price of the asset will move is forecast based on the similarity measure.

Owner:C4CAST COM

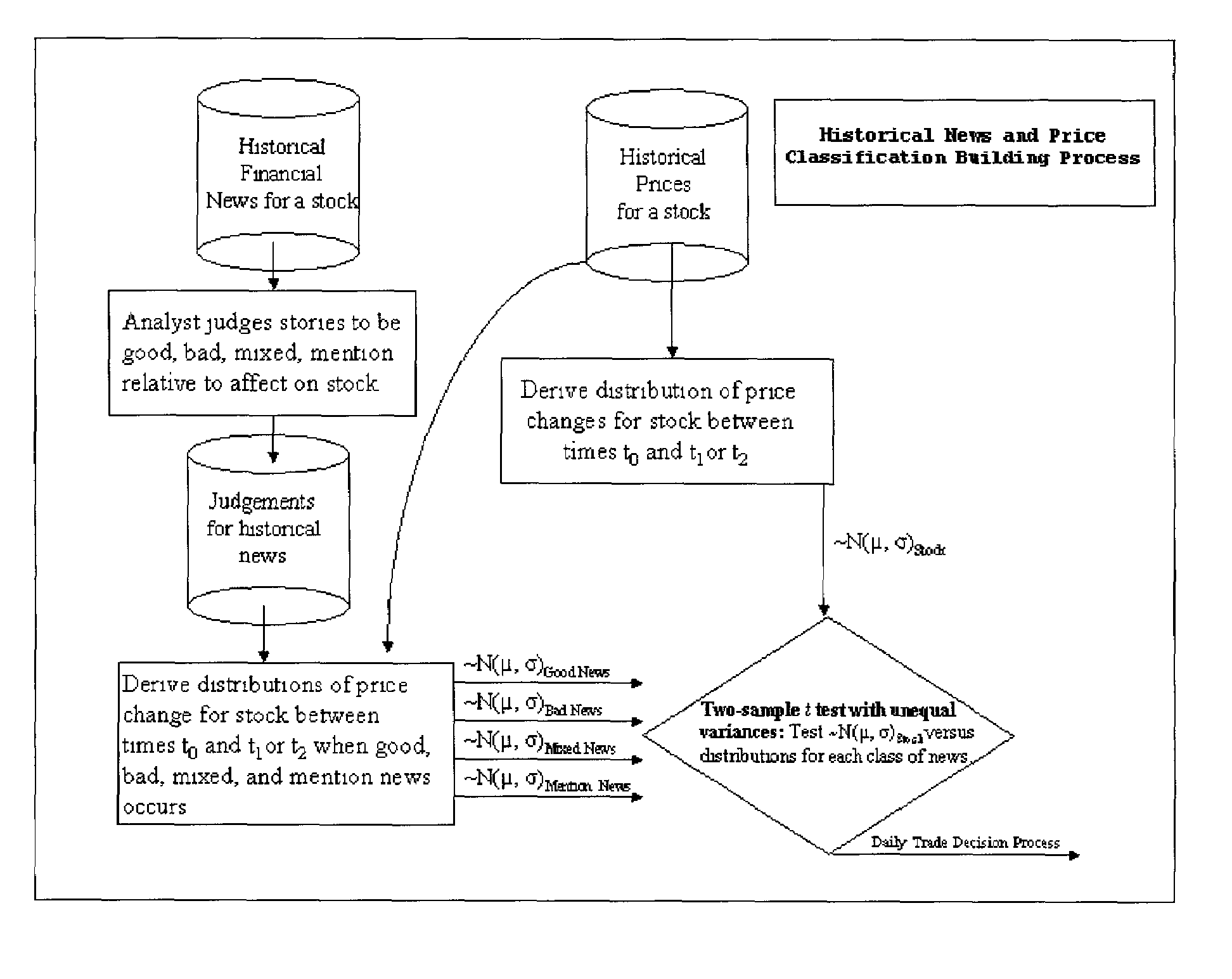

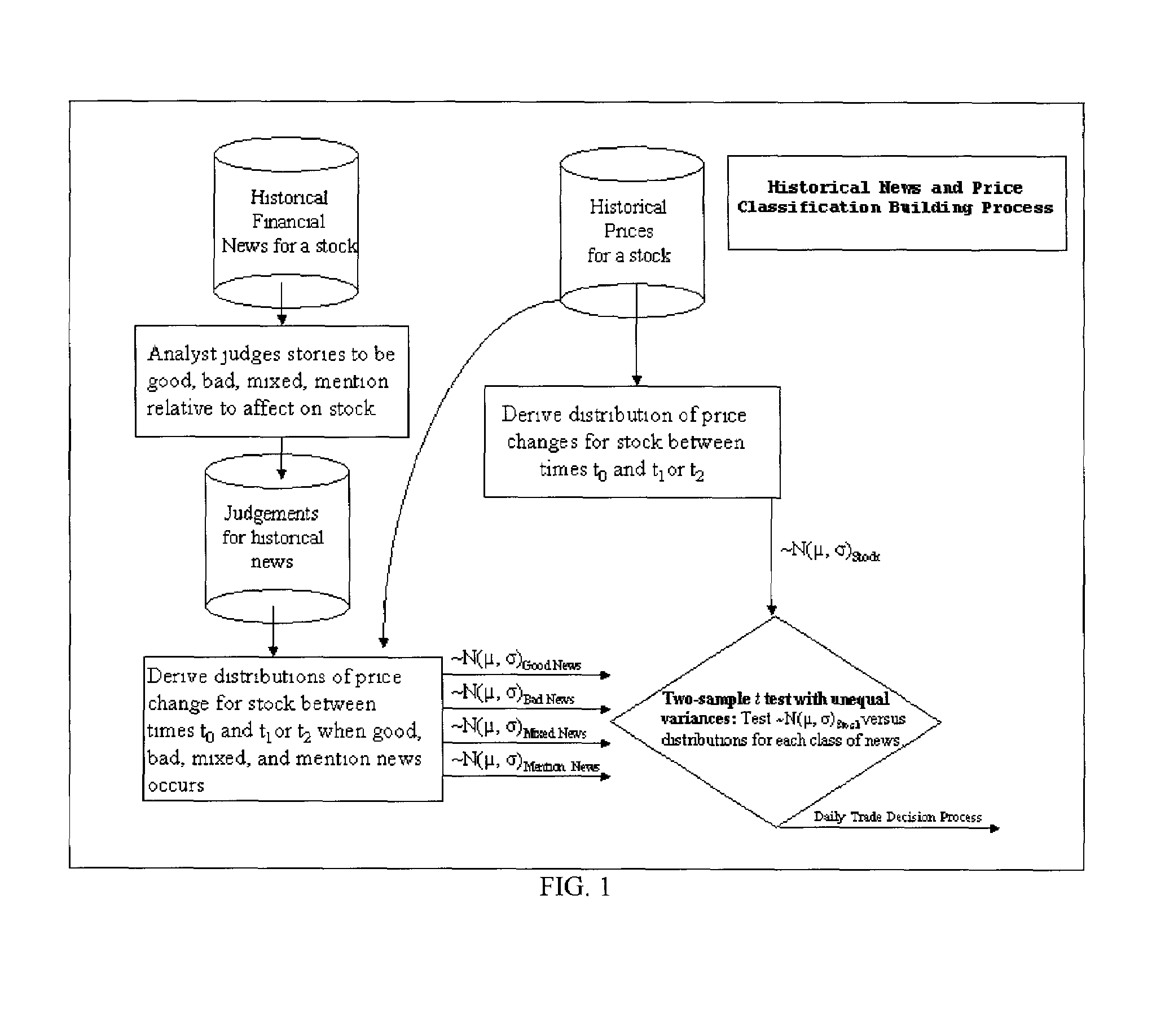

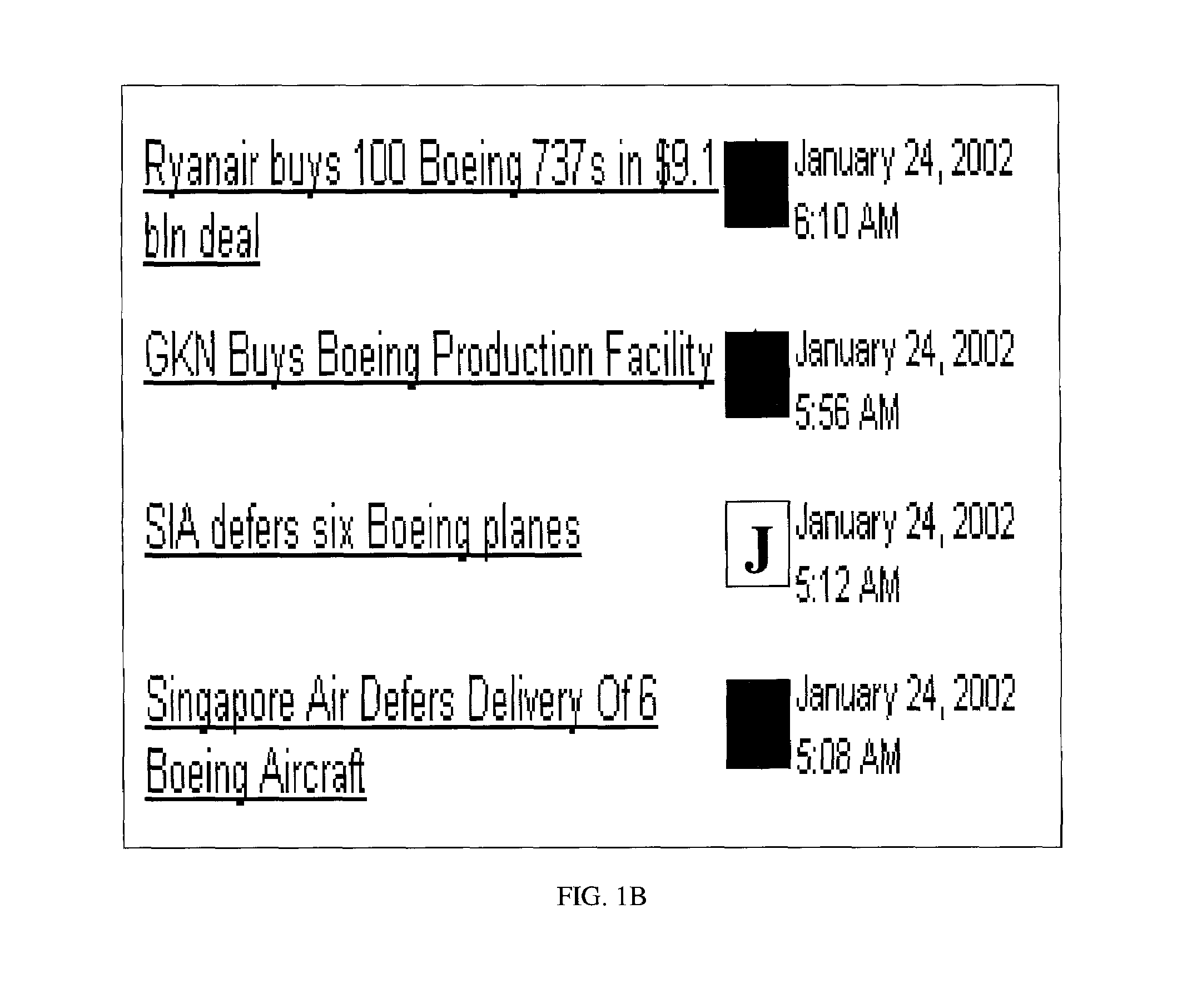

System and method for predicting security price movements using financial news

A method of creating a price prediction model that forecasts short-term price fluctuations in financial instruments by collecting, analyzing and classifying financial news for a financial instrument into categories. Distributions for the changes in price of the financial instrument for a set period of time and distributions for the changes in price of the financial instrument as a result of the financial news for each news category for a set period of time are then obtained. If the distributions for the changes in price of the financial instrument are statistically significantly different than the distributions for the changes in price of the financial instrument for a particular news category, and the mean for the change in price is greater or less than zero, a signal is produced indicating the trading action that should be taken for the financial instrument.

Owner:PAPKA RON

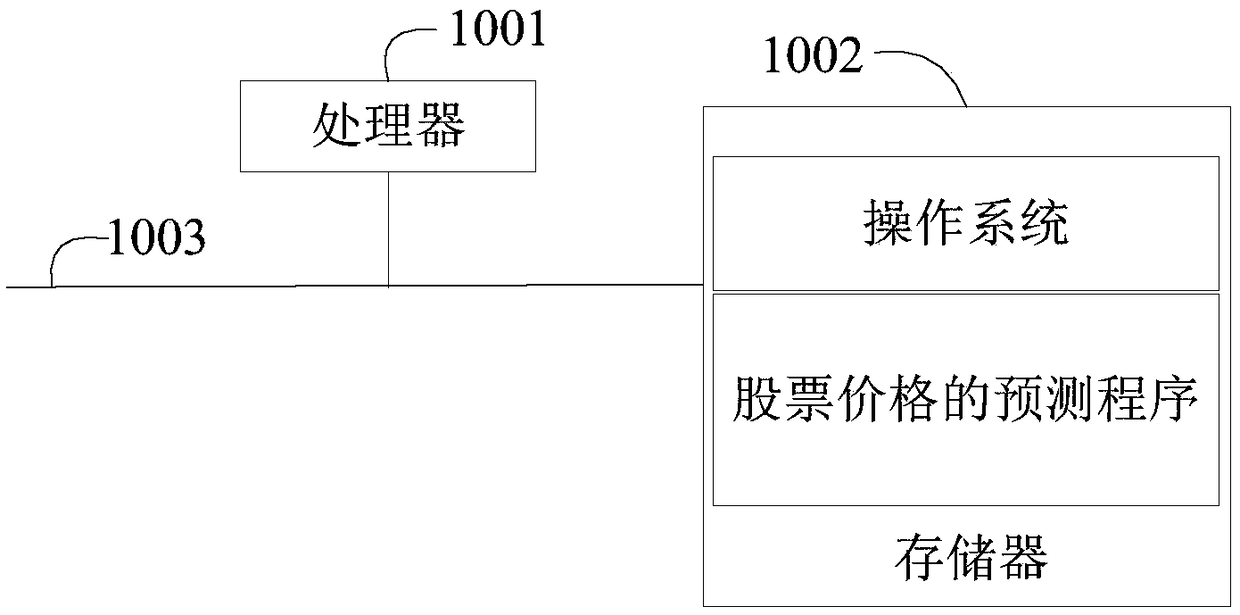

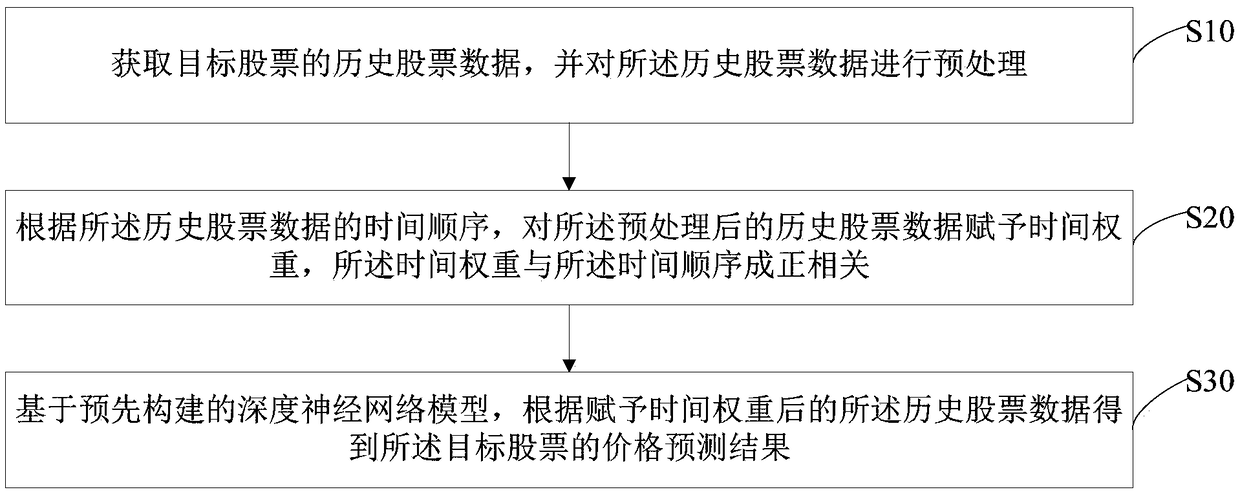

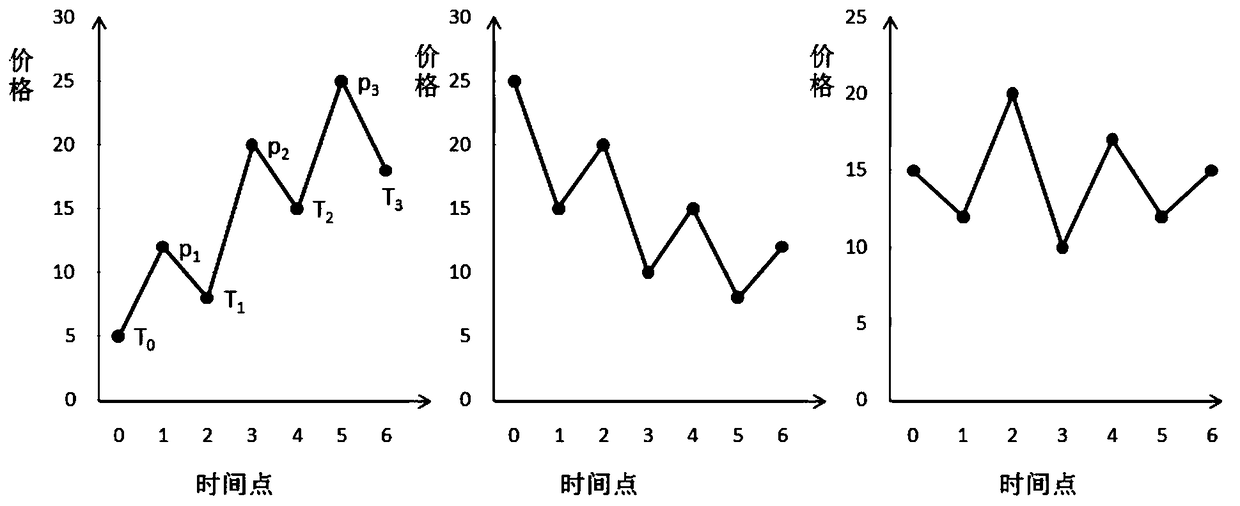

Stock price prediction method, server, and storage medium

The invention discloses a stock price prediction method, comprising the following steps: acquiring historical stock data of a target stock and preprocessing the historical stock data; Assigning time weights to the pre-processed historical stock data according to the time order of the historical stock data, the time weights being positively correlated with the time order; Based on a pre-constructeddepth neural network model, a price prediction result of the target stock is obtained according to the historical stock data given a time weight. The invention also discloses a server and a computer-readable storage medium. The present invention improves the accuracy of the predicted stock price by giving greater weight to the historical stock data which is closer to the time point of the price predicting result and generating the price predicting result based on the depth neural network model according to the historical stock data.

Owner:SUN YAT SEN UNIV

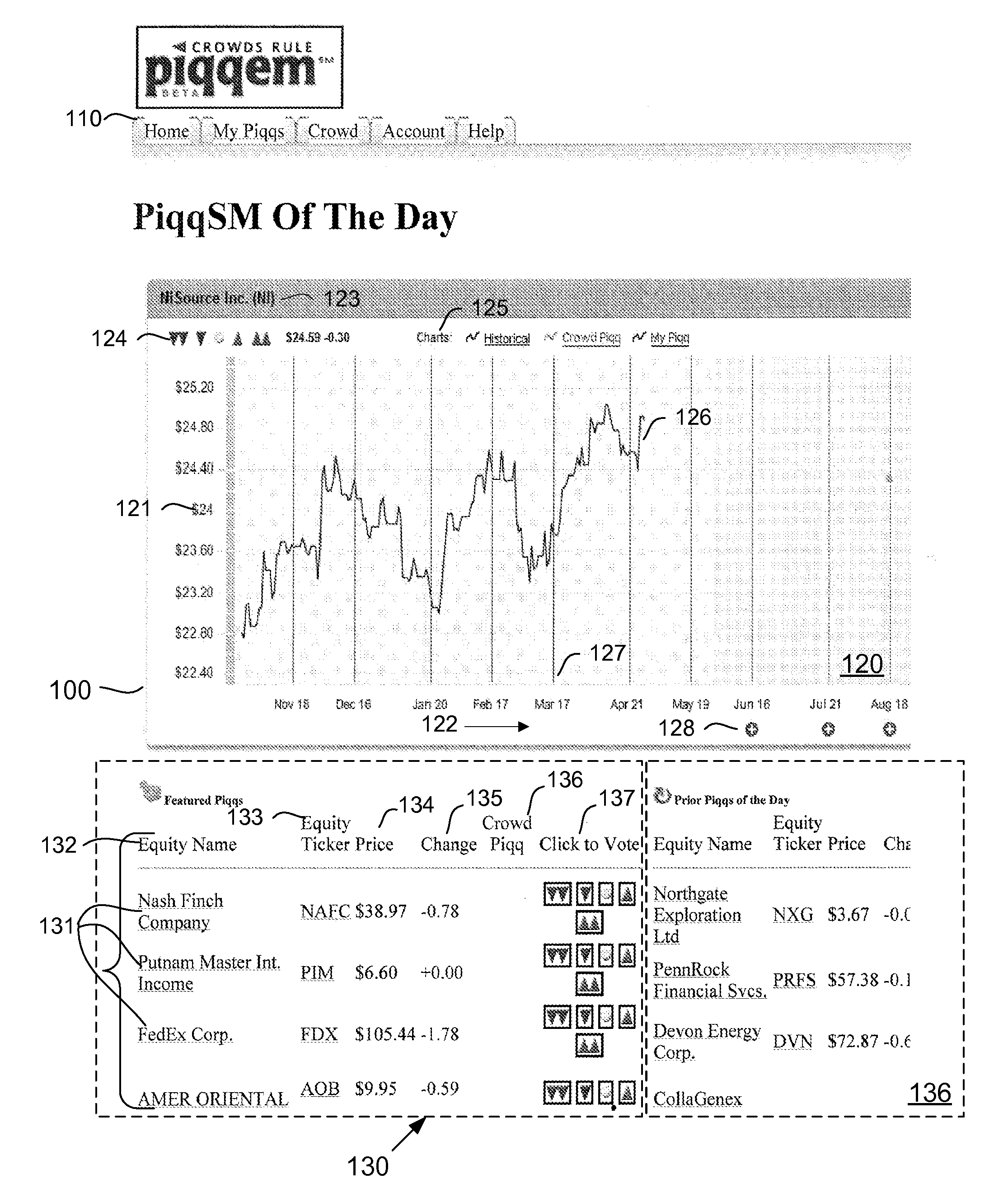

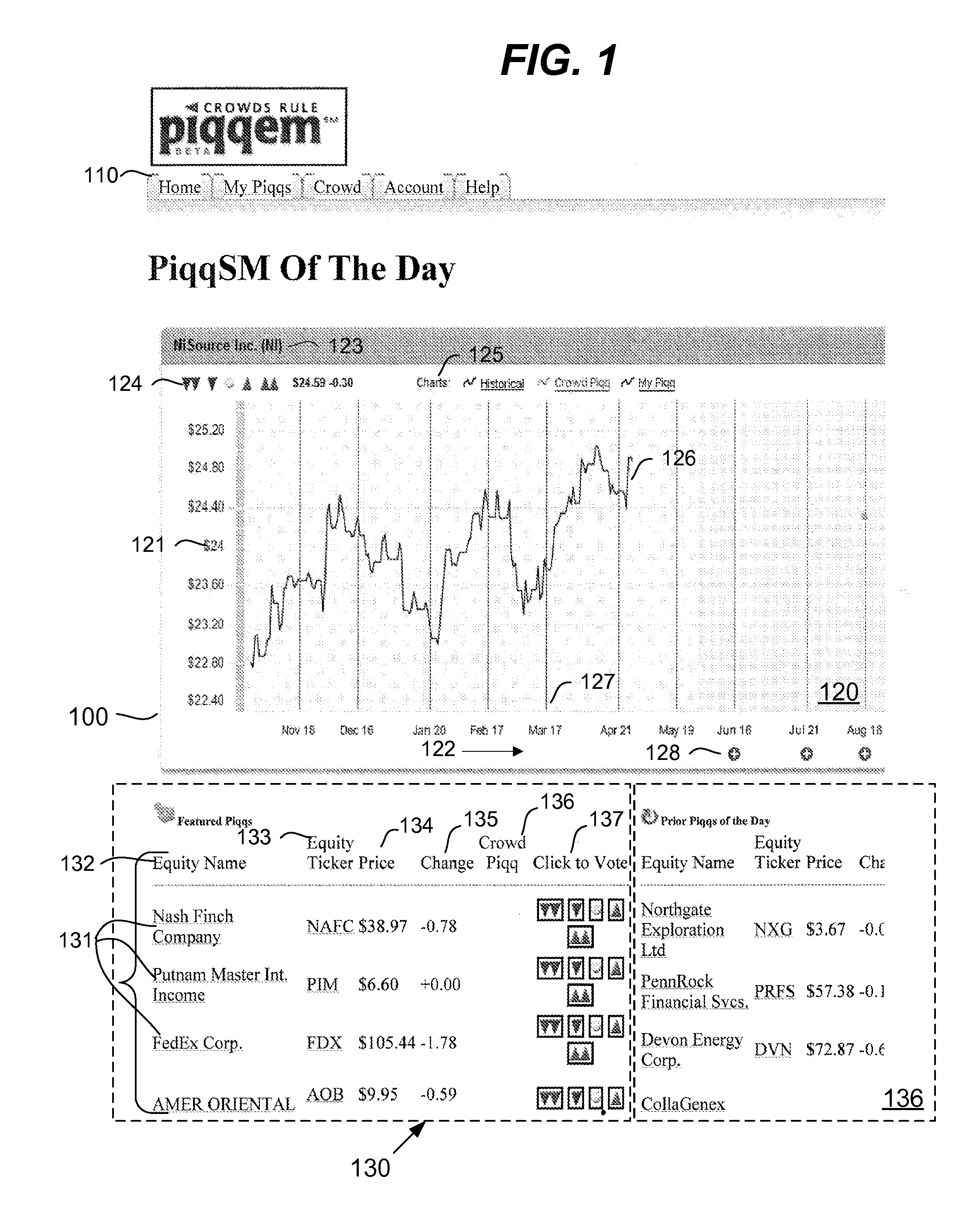

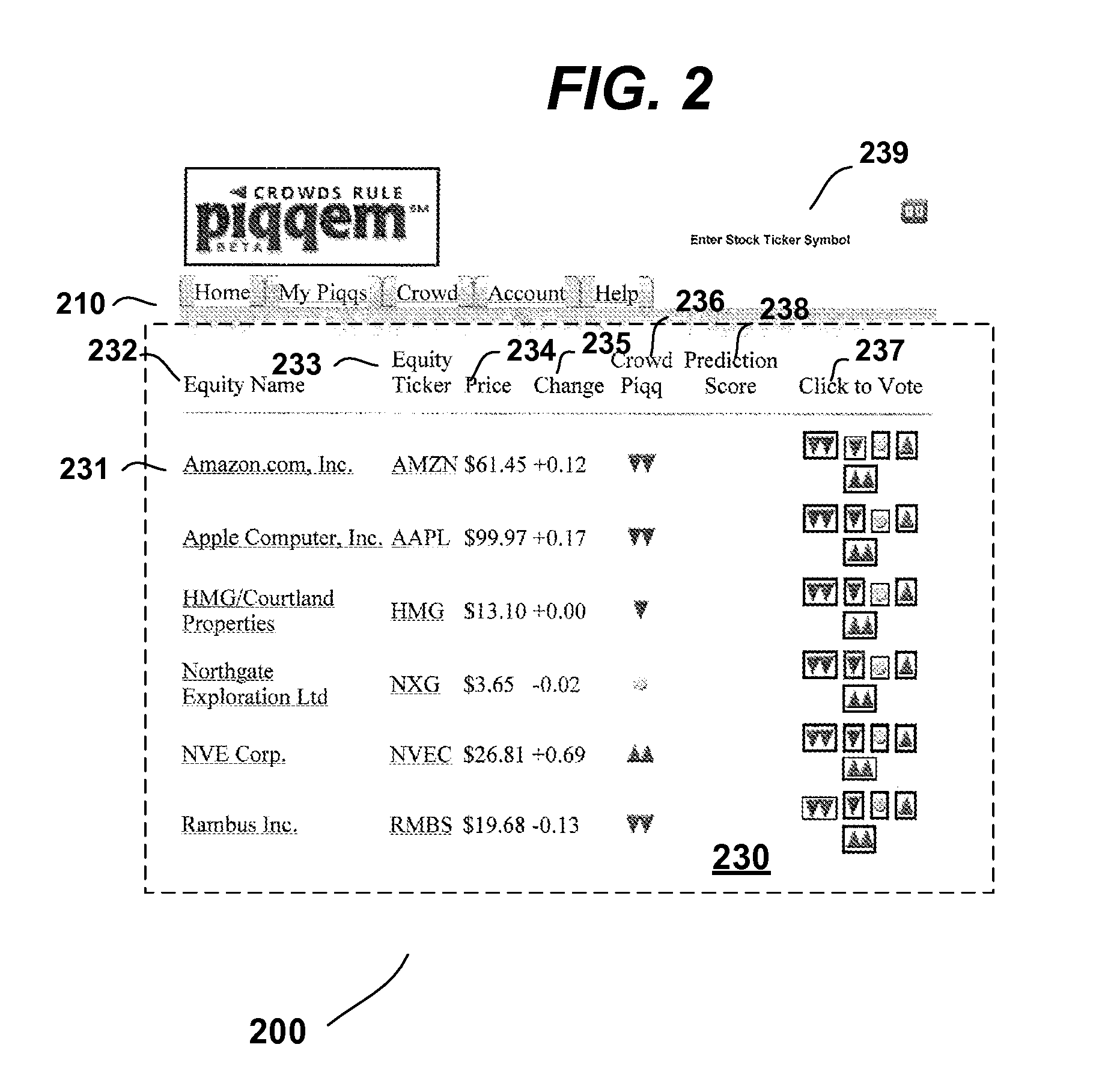

Online Community-Based Vote Security Performance Predictor

An Internet based community predictor for equities and other assets collects and compiles member votes and makes predictions based on overall community statistics. Individual votes are cast by members representing price predictions for particular equities over a target period. By relying on aggregated data it is possible to make more accurate forecasts for the behavior of other populations as well.

Owner:TEVANIAN AVADIS +1

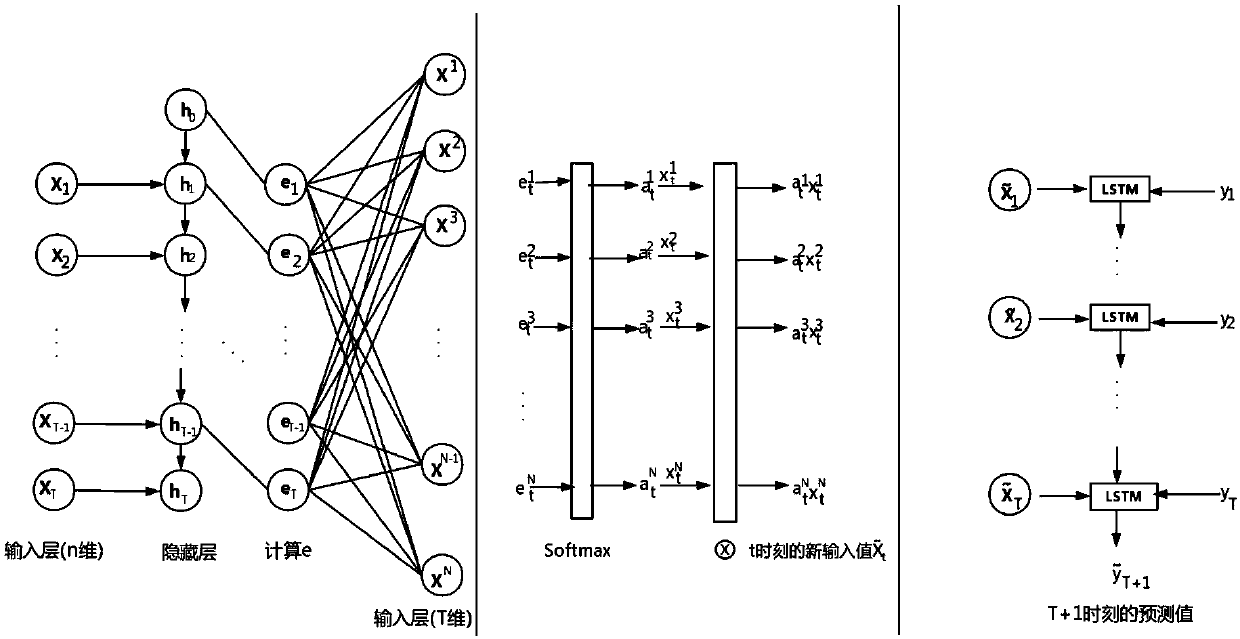

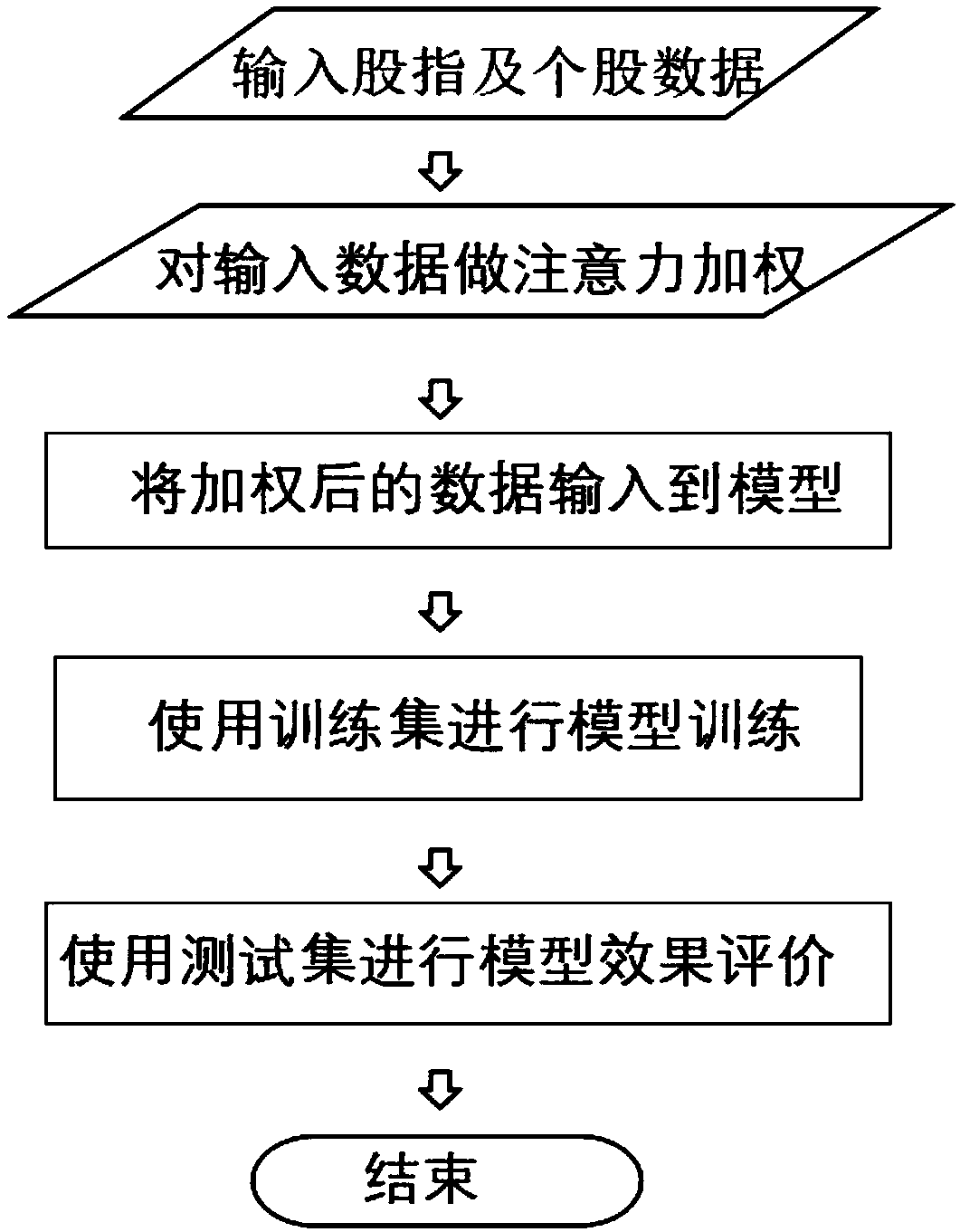

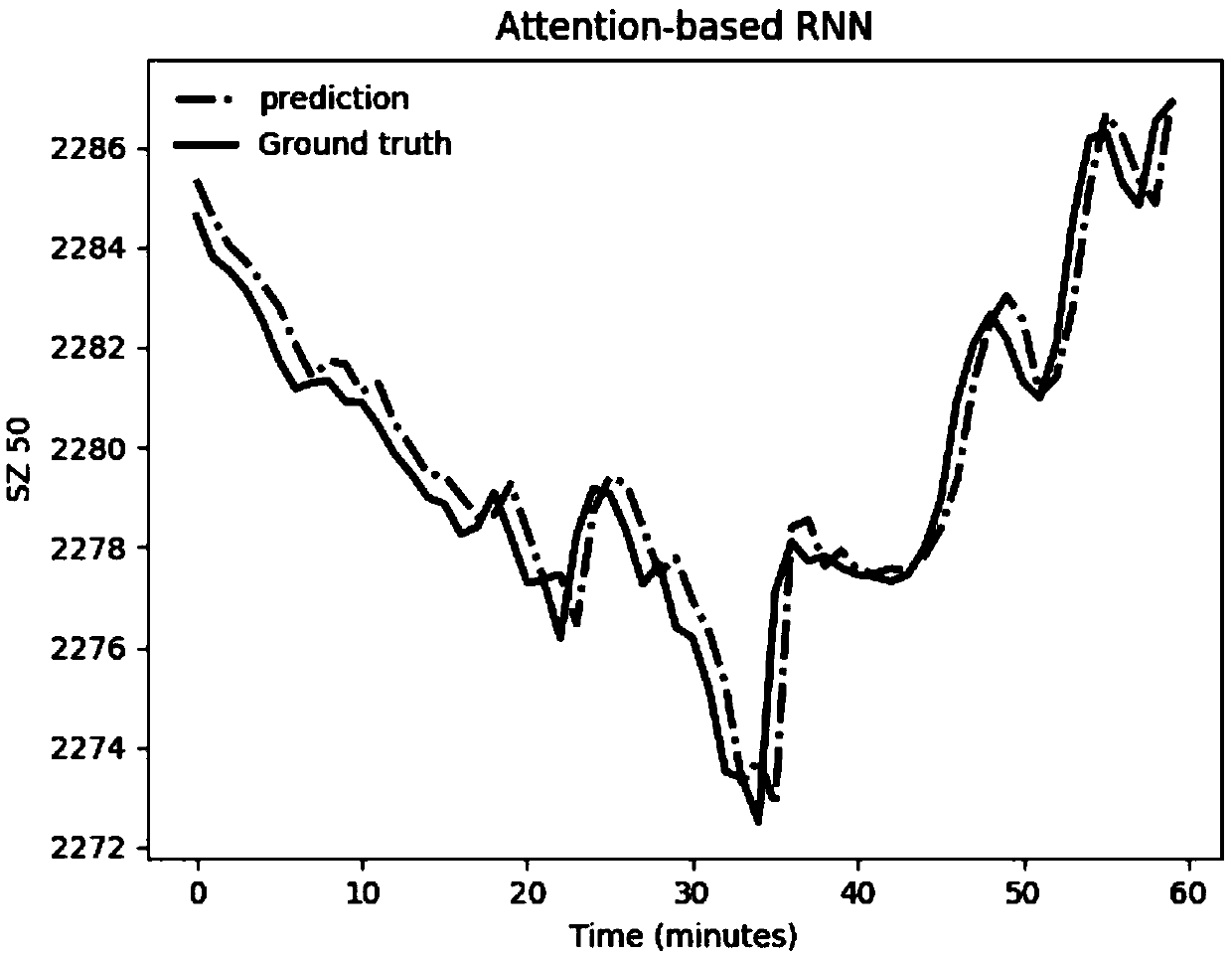

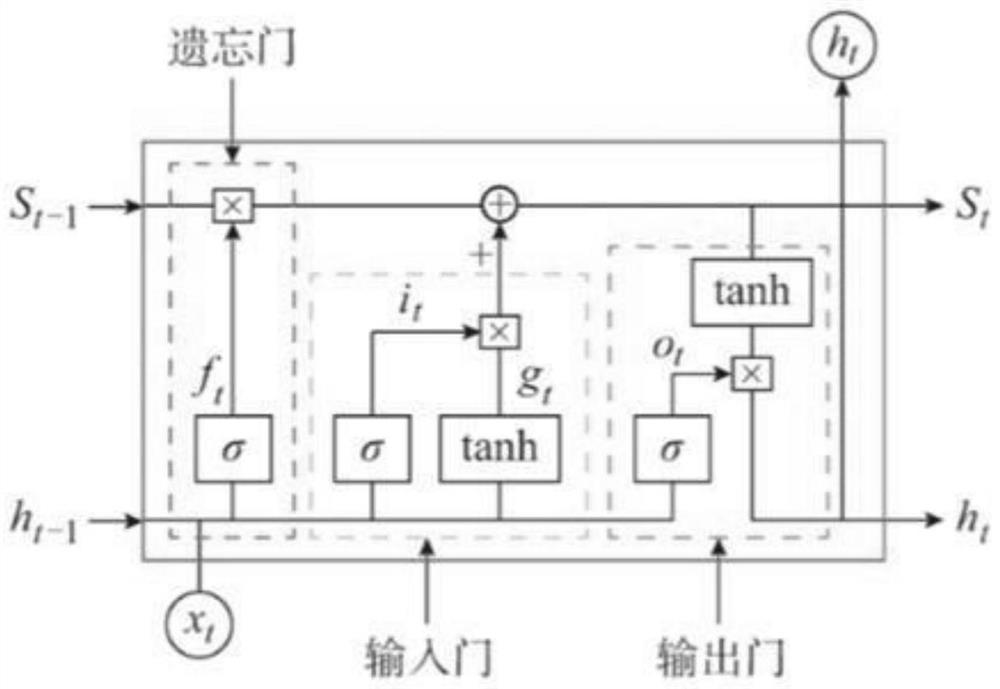

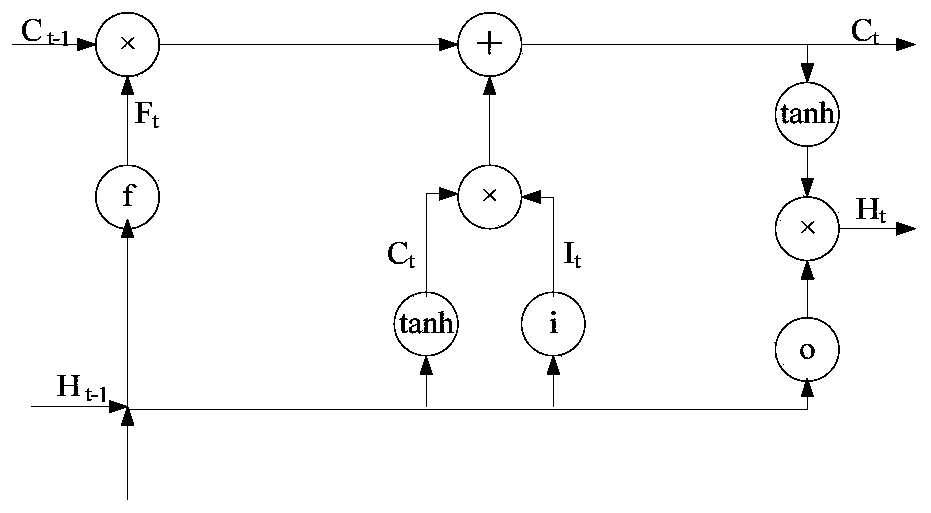

Method based on cyclic neural network for predicting stock index price

InactiveCN108154435AAccurate predictionImprove balanceFinanceForecastingWeight adjustmentData mining

Disclosed is a method based on a cyclic neural network of an attention mechanism for predicting a stock index price. The method comprises the following specific steps of 1) collecting and cleaning stock indexes and historical price data of a single stock, wherein the stock indexes include the historical price data; 2) using the attention mechanism to conduct weighting adjustment on model input values; 3) inputting the weighted model input values into the cyclic neural network for model training and prediction. By means of the method, the deep features of various influence factors of the stockindex price can be ingeniously extracted, and compared with a simple one-factor cyclic network or a traditional multi-factor cyclic network, the method can improve the accuracy of predicting the stockindex price.

Owner:ZHEJIANG UNIV OF TECH

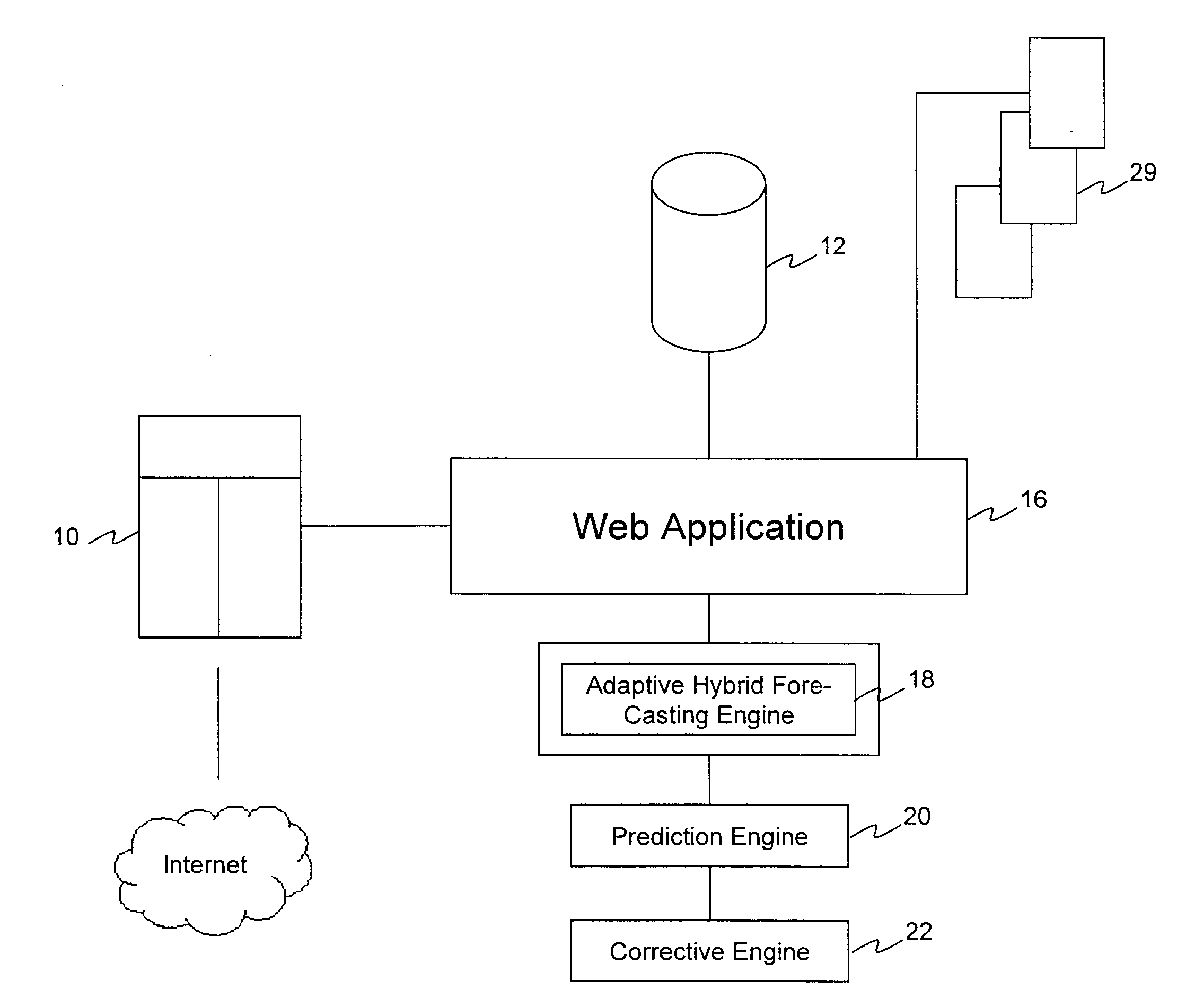

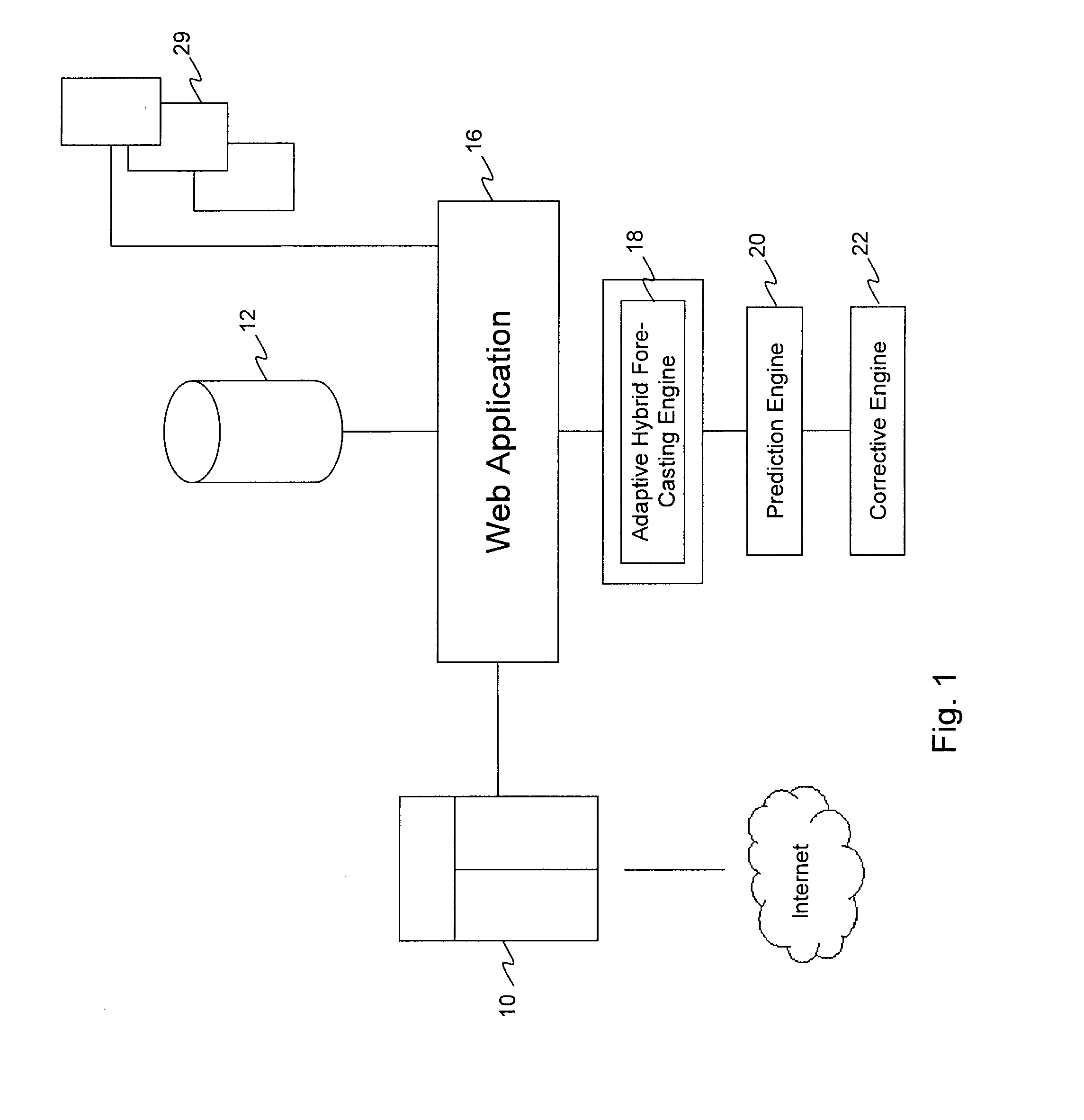

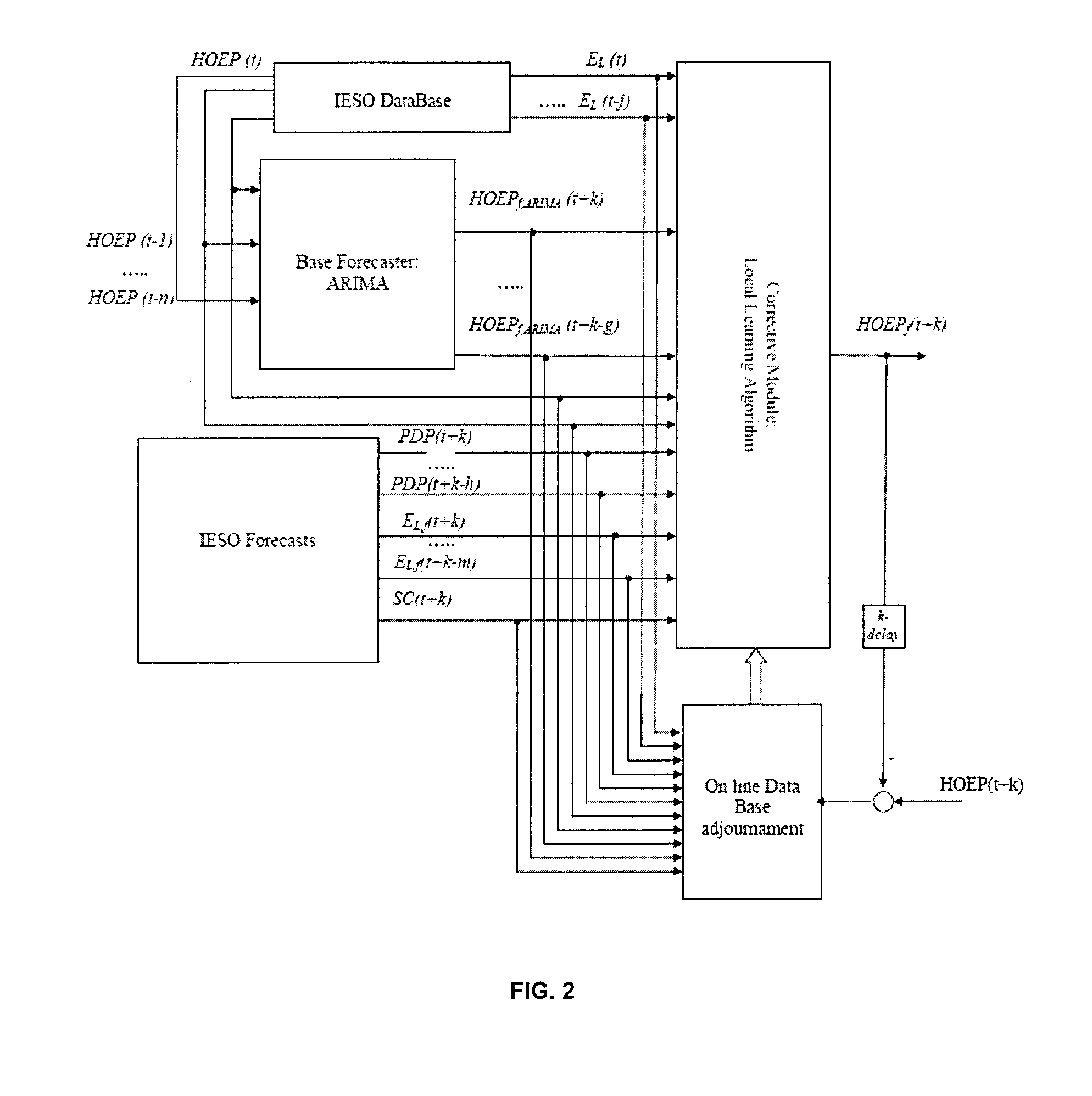

System , method and computer program forecasting energy price

A system, method and computer program for forecasting energy price is provided that includes an adaptive hybrid forecasting engine. The adaptive hybrid forecasting engine is operable to generate an energy price forecast based on both a prediction utility and a correction utility. The prediction utility may implement a linear modeling algorithm for predicting energy price based on historical data. The linear modeling algorithm may be a multiplicative seasonal ARIMA (Autoregressive Integrated Moving Average) model, for example, which includes both a regular ARIMA and seasonal ARIMA model. The correction utility may implement an adaptive dynamic correction algorithm that is operable to adapt the energy price forecast based on current or near-current conditions. The adaptive dynamic correction algorithm may be a LL (lazy learning) algorithm.

Owner:ENERGENT

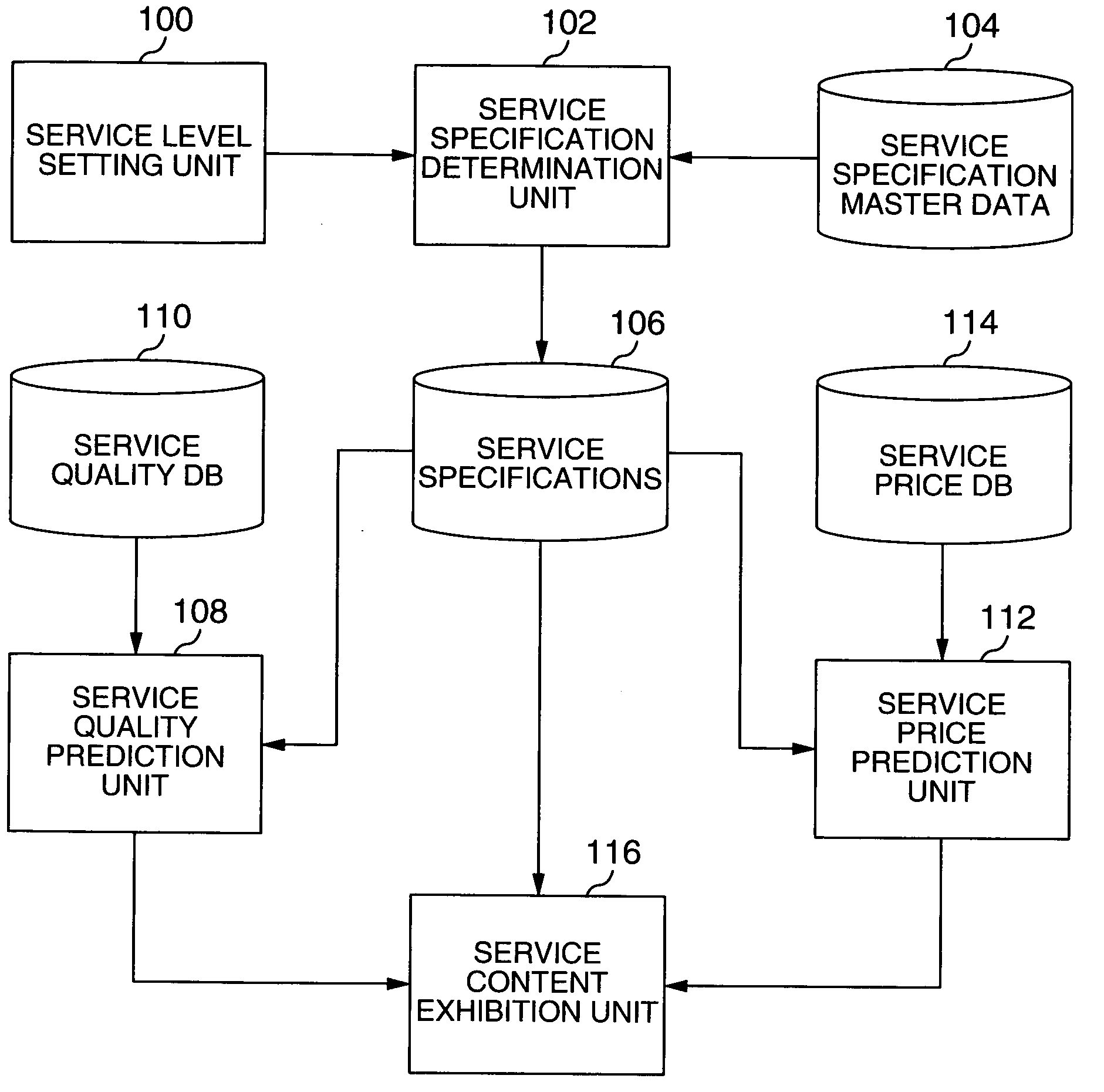

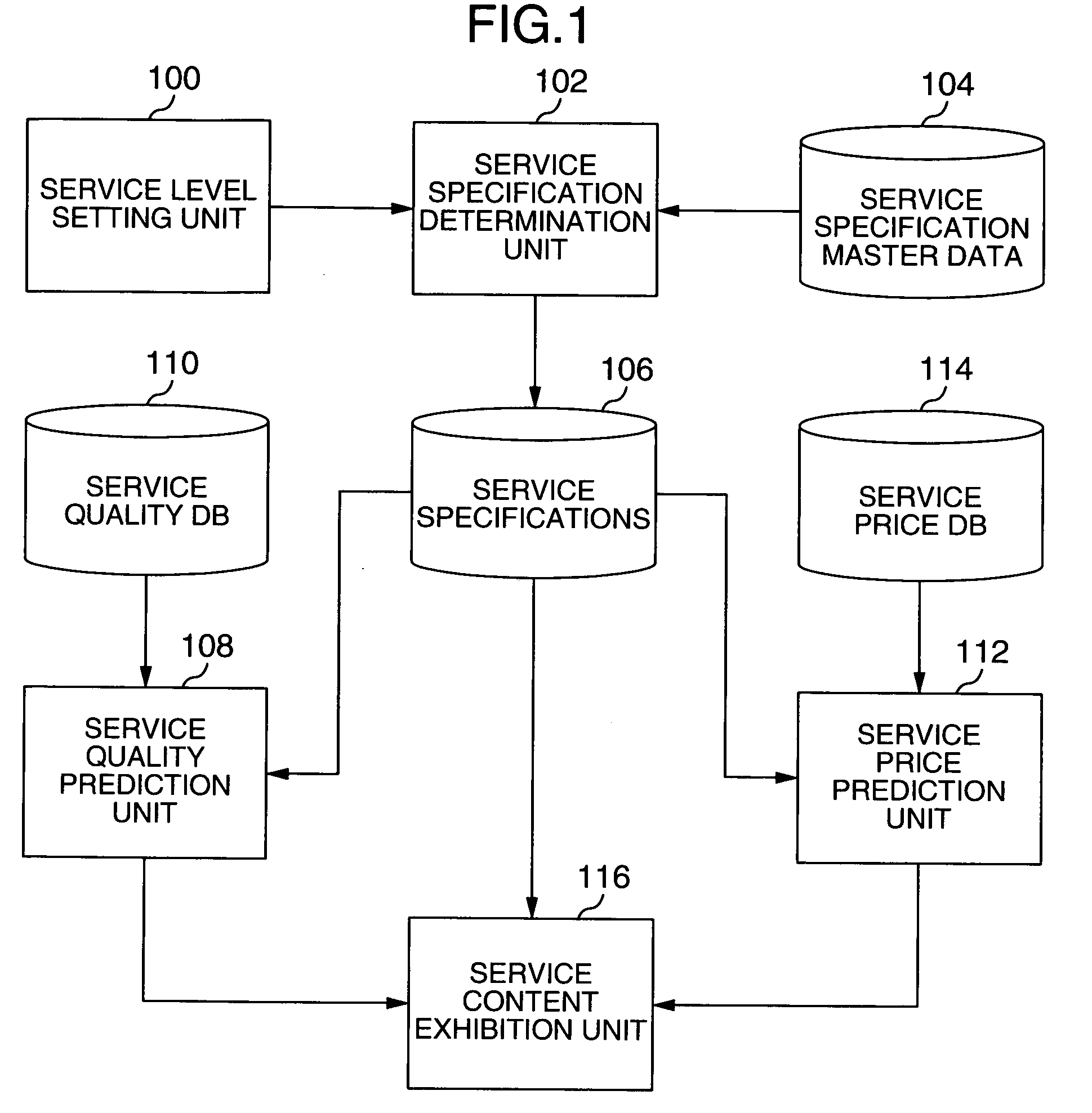

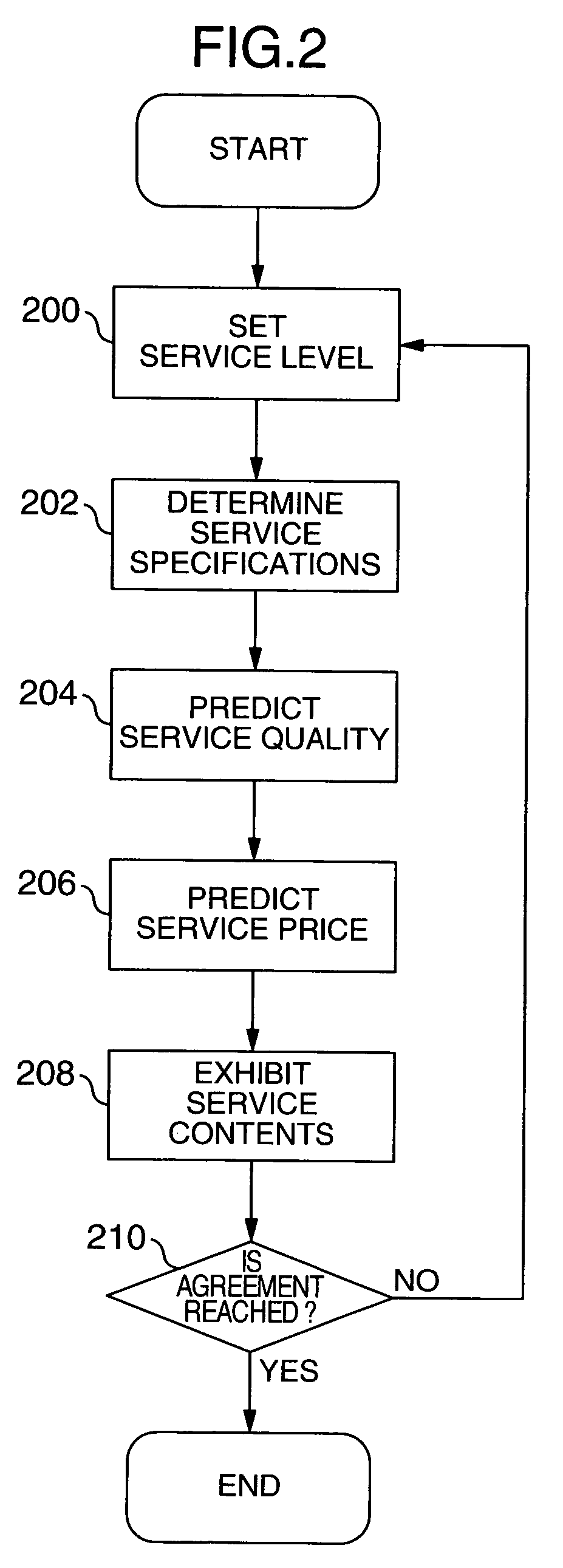

Service level agreements supporting apparatus

InactiveUS20050283376A1Customer satisfactionBuying/selling/leasing transactionsSpecial data processing applicationsService-level agreementEngineering

A service level agreements supporting apparatus that makes it possible to adjust the service level and select a service satisfying the customer, for maintenance service of buildings and facilities involving work specifications. The apparatus has a service level setting unit for setting a service level, a service specification determination unit for determining work specifications of a service corresponding to the set service level, a service quality prediction unit for predicting a service quality based on the determined work specifications, a service price prediction unit for predicting a service price based on the determined work specifications, and a service content exhibition unit for exhibiting these kinds of information.

Owner:HITACHI LTD

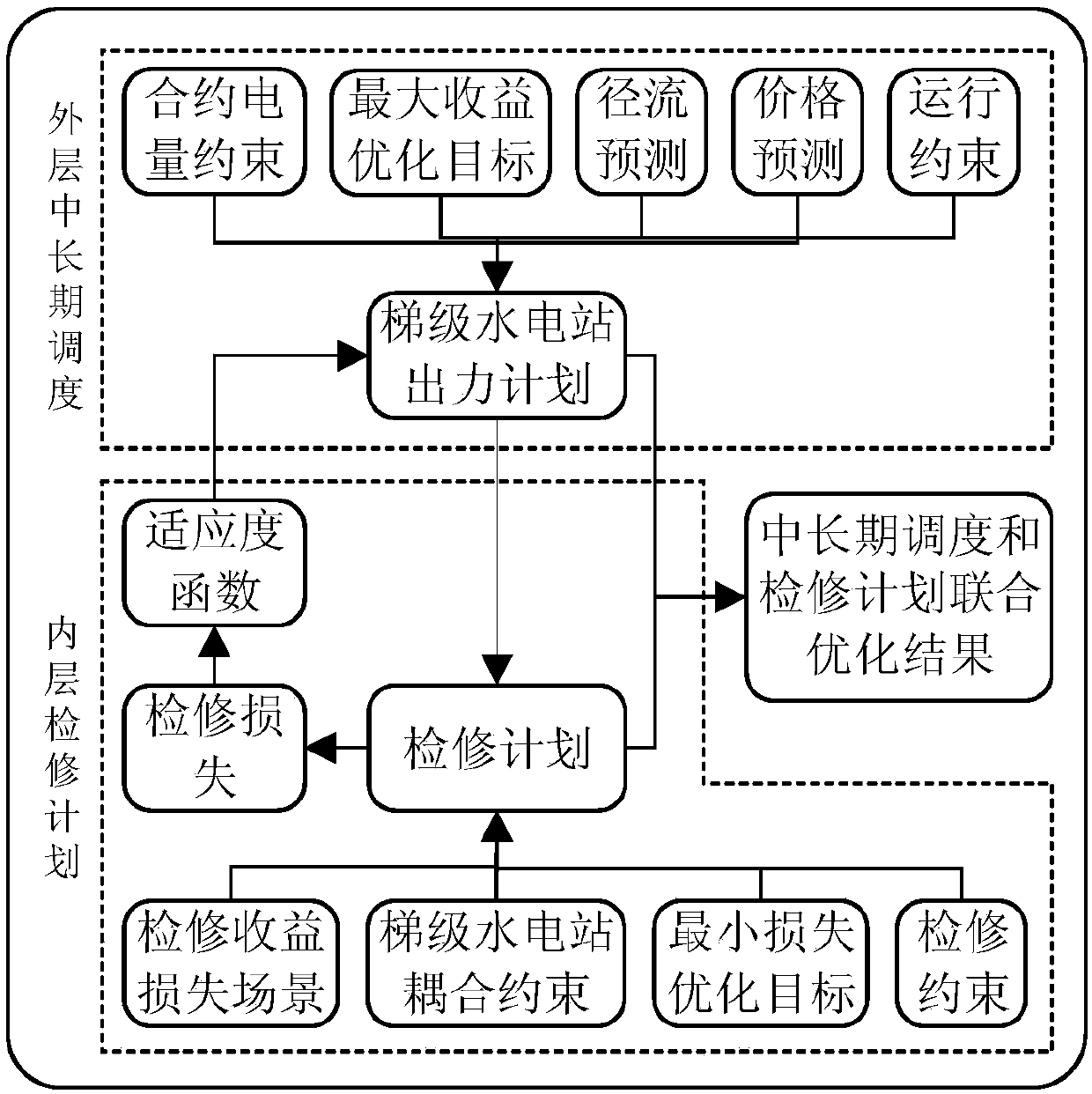

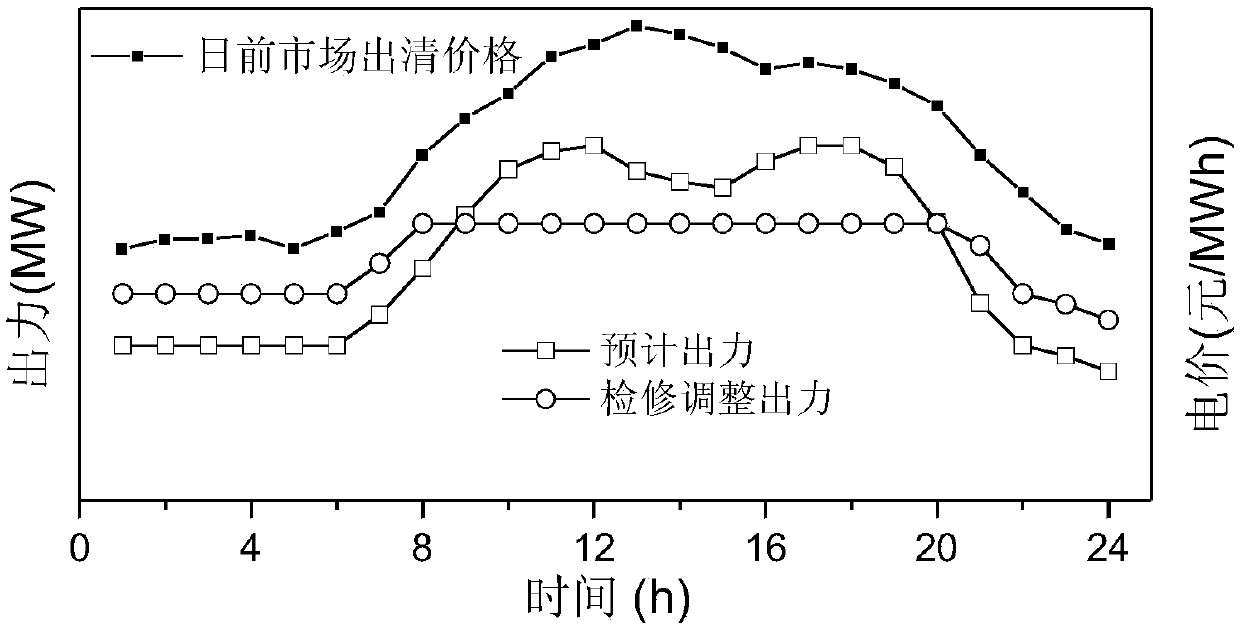

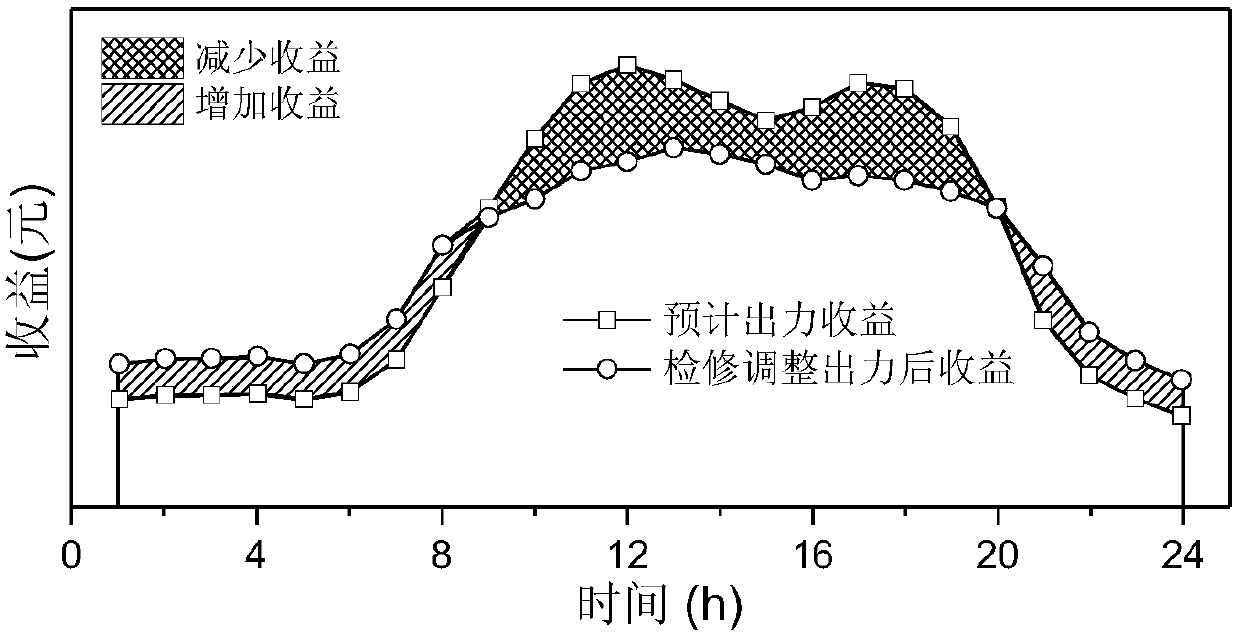

A method for optimizing medium- and long-term scheduling and repair plans of cascade hydropower stations in a market environment

ActiveCN107895221AMeet actual operating needsMarket predictionsResourcesProgram planningPrice prediction

The invention belongs to the technical field of scheduling and repair of cascade hydropower stations and in particular relates to a method for double-layer optimization of medium- and long-term scheduling and repair plans of cascade hydropower stations in a market environment. According to the invention, in order to reduce the influence of repair plans of cascade hydropower stations on operation revenue, a cascade hydropower station medium- and long-term scheduling and repair plan double-layer optimization model is built to achieve joint optimization of medium- and long-term scheduling and repair plans. In a medium- and long-term scheduling optimization process, decisions are made according to runoff and price prediction and the genetic algorithm is employed to optimize the output of cascade hydropower stations in each period so as to search for the optimal revenue space. In a repair plan optimization process, with priority being given to the influence of the coupling relationships ofwaterpower and electric power of cascade upstream and downstream hydropower stations on repair plans and with an intermediate result of medium- and long-term scheduling being a boundary condition andthe minimum repair loss being an optimization target, the repair loss optimization result and the medium- and long-term power generation revenue are combined to be total revenue, so that joint optimization is achieved.

Owner:北京微肯佛莱科技有限公司 +3

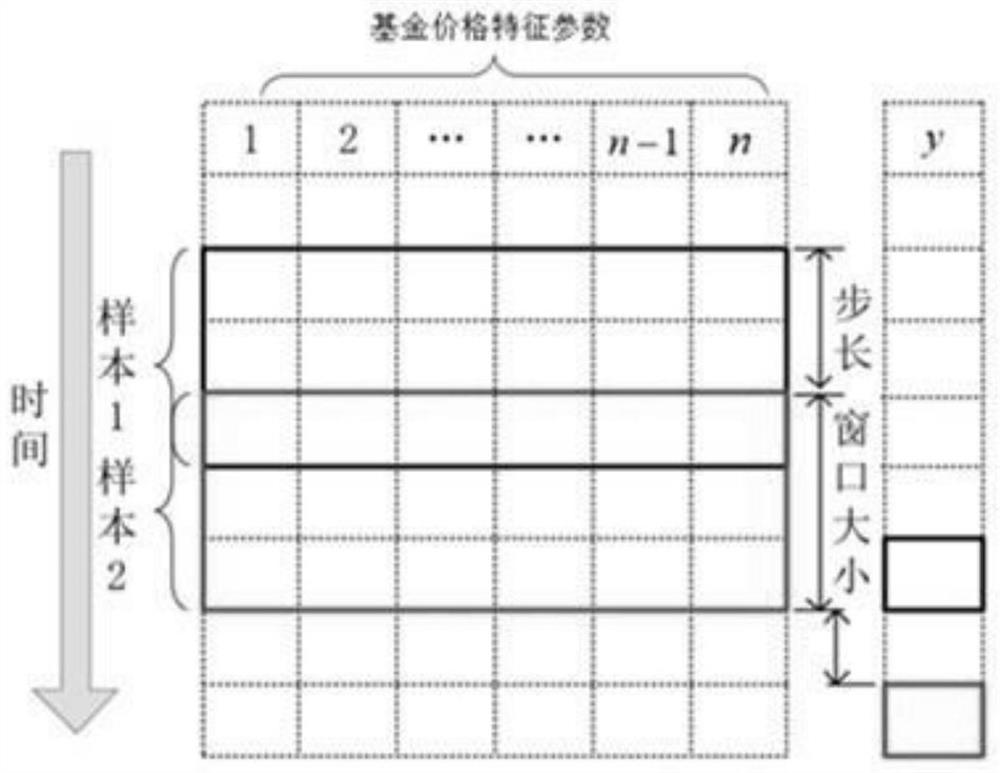

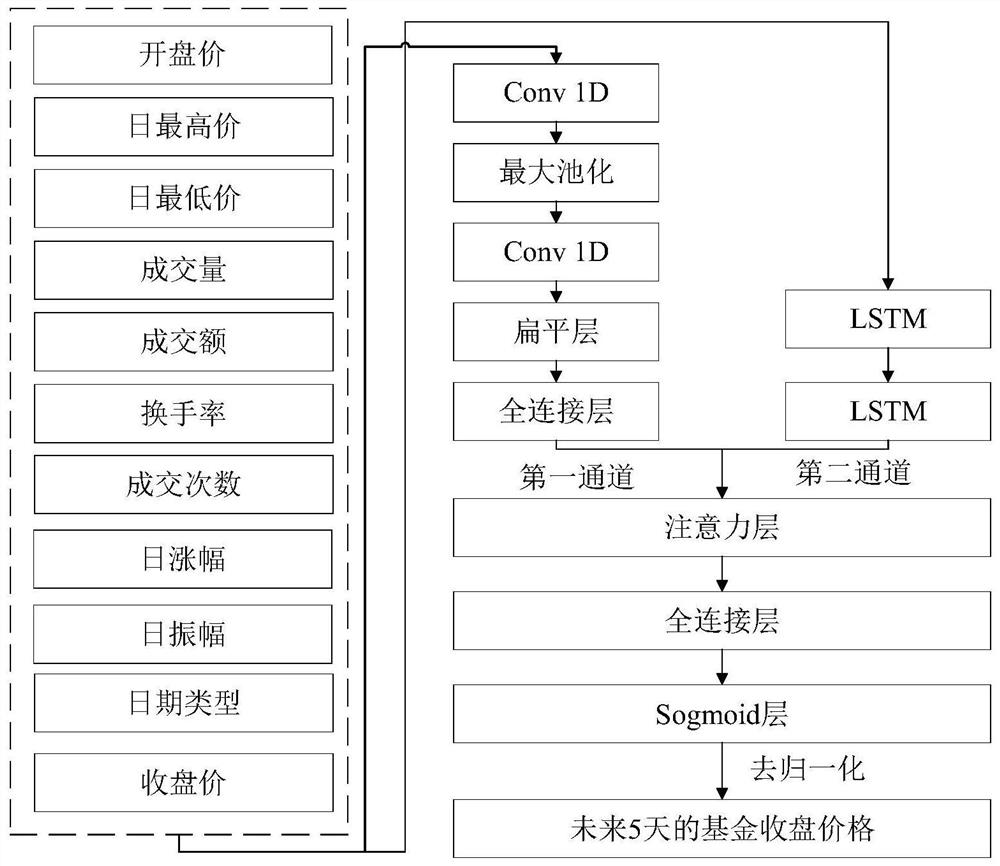

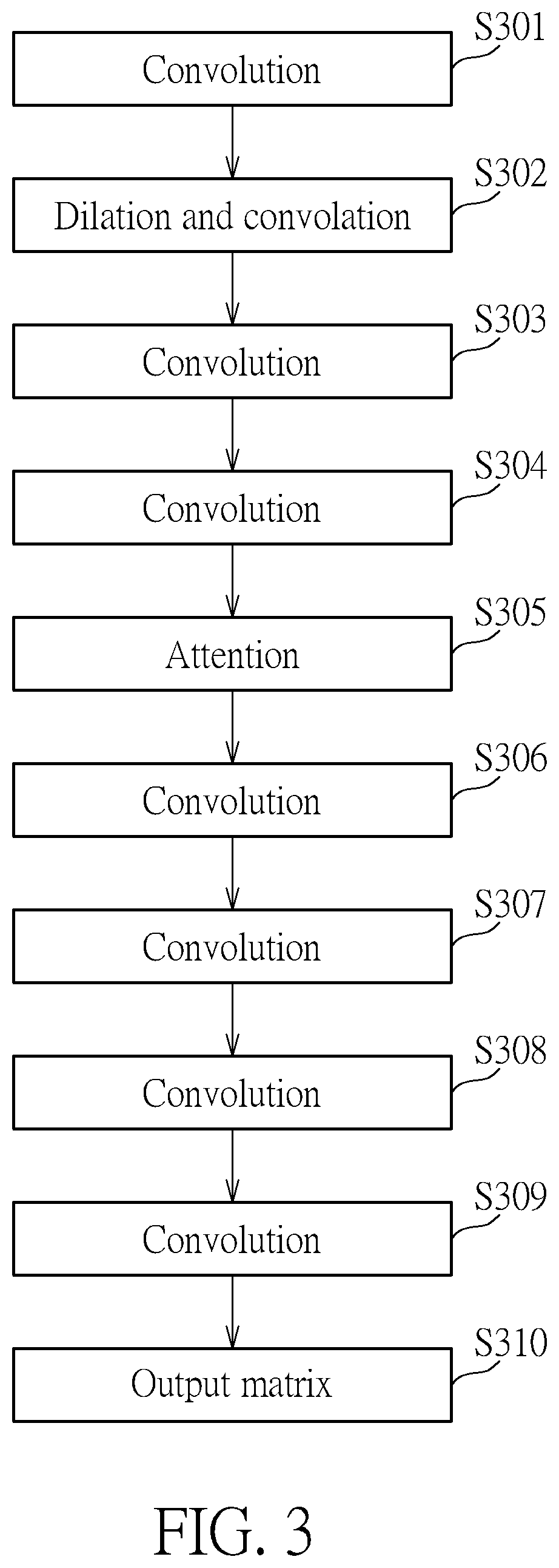

CNN-LSTM network fund price prediction method based on attention combination

InactiveCN111626785AImprove robustnessImprove forecast accuracyMarket predictionsFinanceFeature extractionNetwork model

The invention discloses a CNN-LSTM network fund price prediction method based on attention combination. The method comprises the steps of 1, collecting fund platform data; 2, preprocessing the fund data; step 3, extracting sample features; step 4, establishing a fund price prediction network model; and step 5, training and predicting a fund prediction model. According to the CNN-LSTM network fundprice prediction method based on attention combination provided by the invention, the prediction precision is high, multi-step prediction of fund prices can be realized, and reliable reference information is provided for investors.

Owner:JINLING INST OF TECH

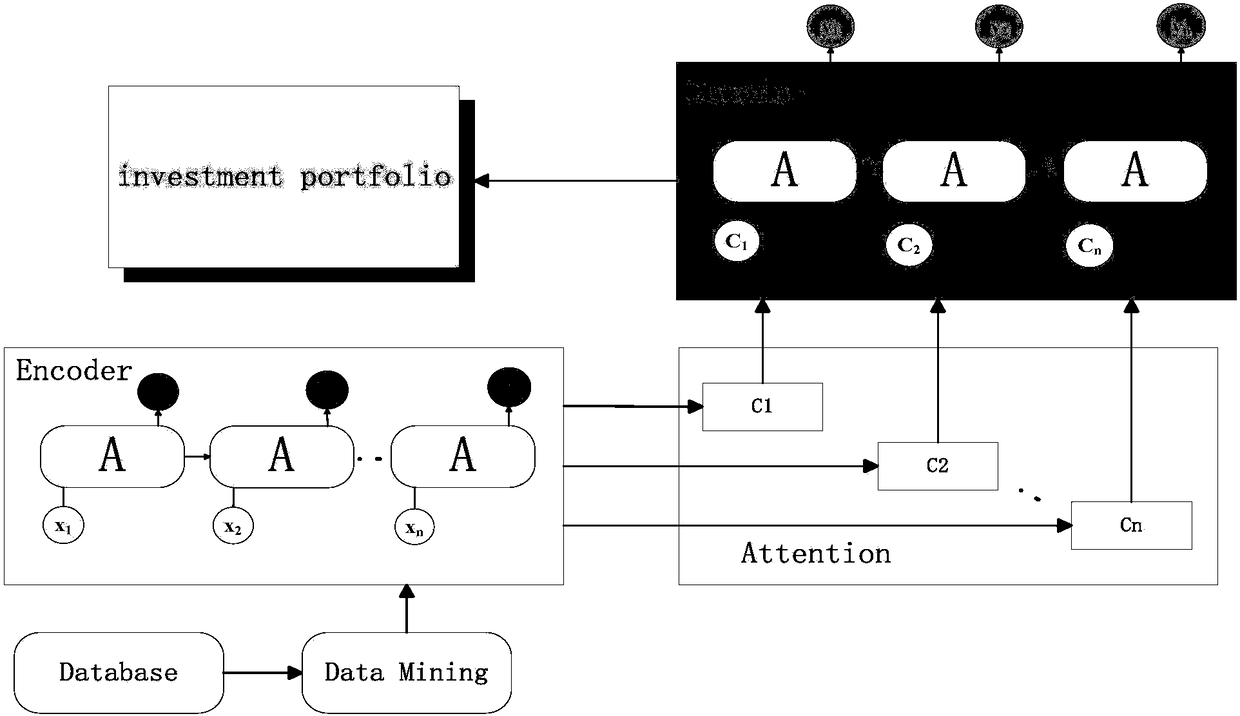

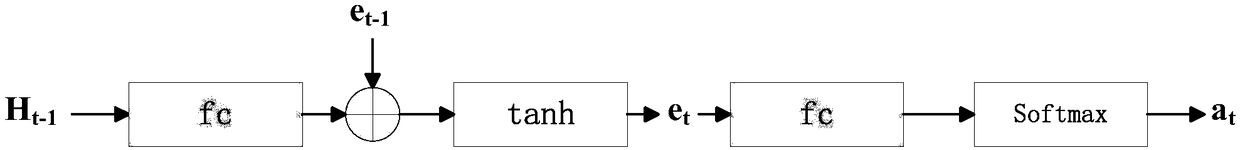

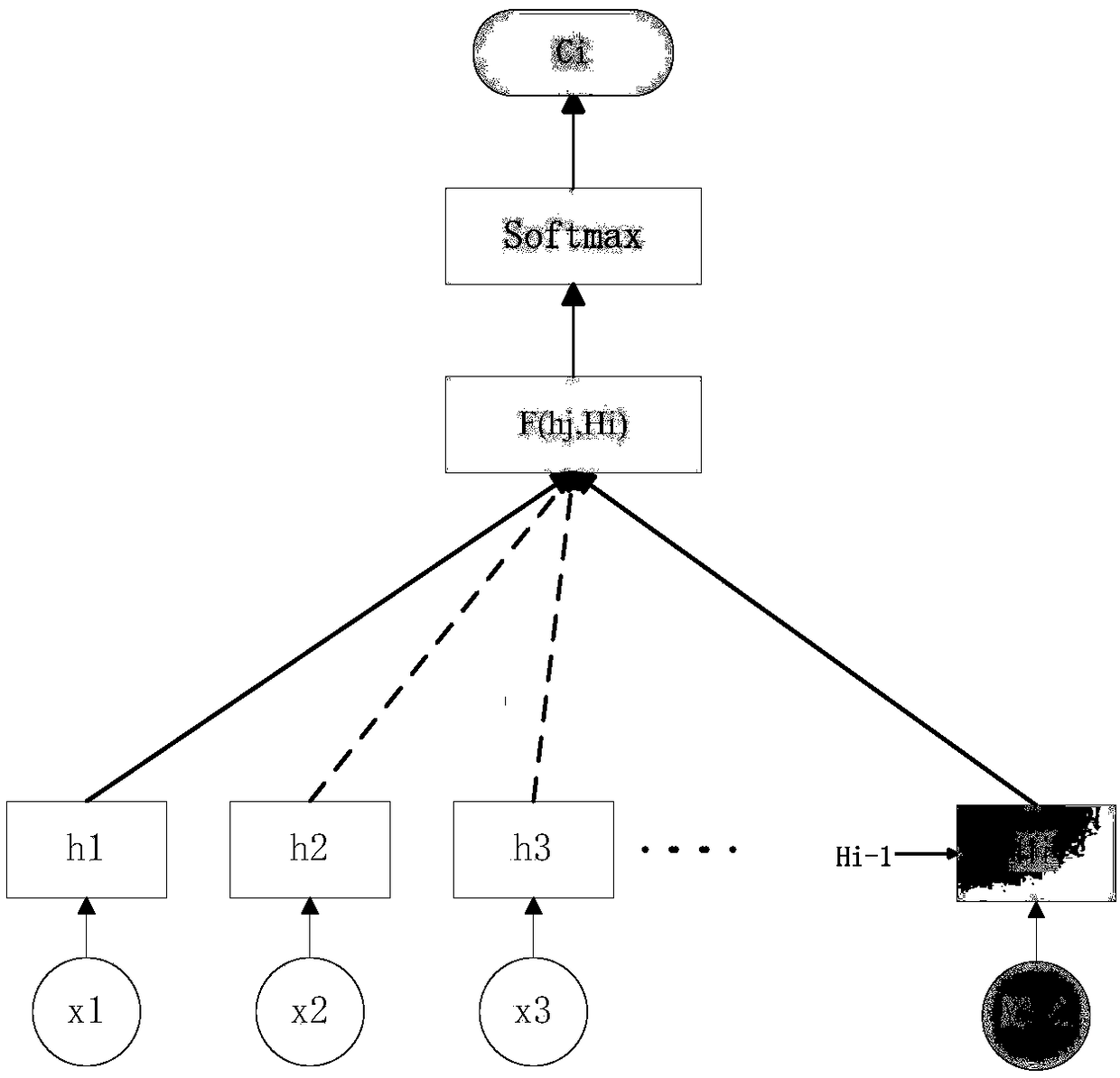

Deep network intelligent investment system data analysis method integrating attention mechanism

ActiveCN108460679AFully consider the dynamic characteristicsOvercome forecast instabilityFinanceShort-term memoryNetwork output

The invention discloses a deep network intelligent investment system data analysis method integrating an attention mechanism. The method includes the following steps that: step 1, financial fields called by a sufficient quantity of local devices are obtained from a financial website and a stock database, the financial fields are filtered and integrated, so that a field X can be obtained; step 2, the field X is inputted into an encoder module, wherein the encoder module is composed of a long-term and short-term memory network, and encodes the X; step 3, an encoded field X vector obtains an attention allocation probability distribution value within a probability distribution value interval through an attention allocation module; step 4, the long-term and short-term memory network in the decoder generates price predictions on the basis of a field code containing attention probability distribution and historical information that has been generated before; step 5, a trained deep network outputs the prediction result of a certain trading day, and compares the prediction result of the trading day with a set threshold value, and the risks of financial products are determined; and step 6, appropriate financial products are screened according to user funds, and an optimal investment portfolio is configured.

Owner:UNIV OF ELECTRONIC SCI & TECH OF CHINA

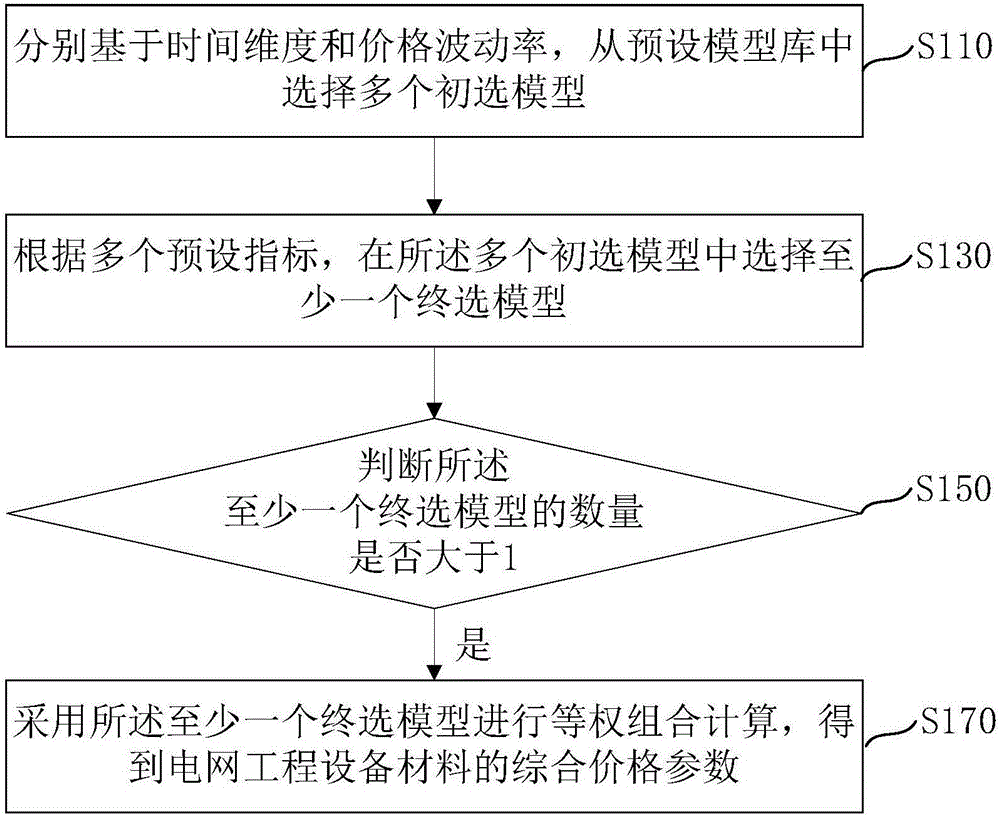

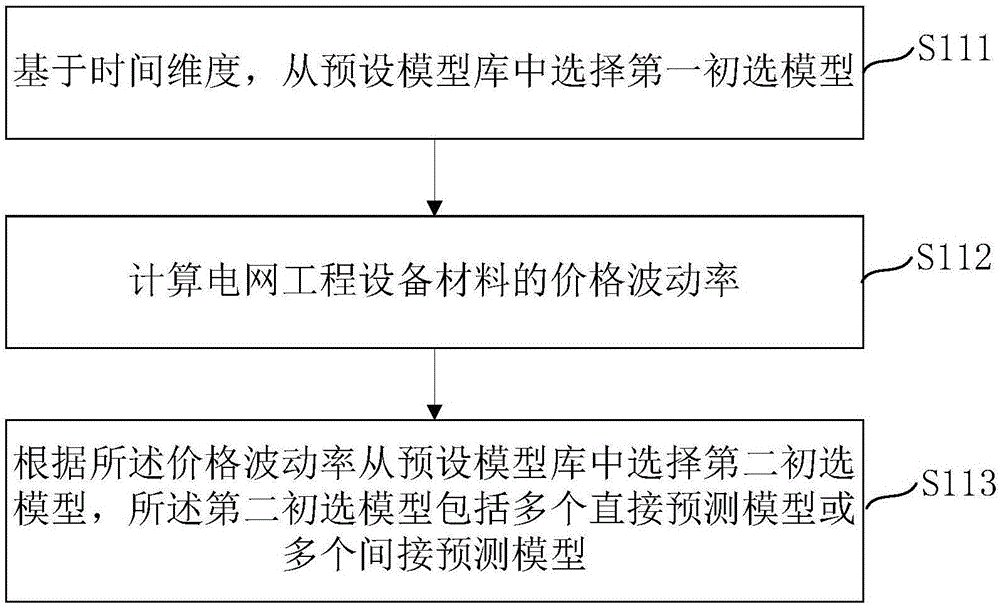

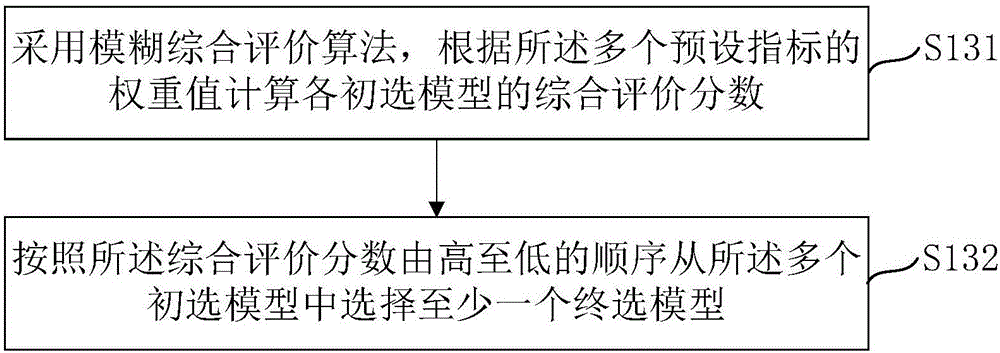

Price parameter generation method and device of power grid project equipment material

The invention provides a price parameter generation method and device of a power grid project equipment material. The price parameter generation method comprises the following steps: selecting a plurality of primary selection models from a preset model library based on a time dimension and a price volatility; selecting at least one final selection model from the plurality of primary selection models according to a plurality of preset indexes; and judging whether the number of the at least one final selection model is greater than 1, and if so, performing equal weight combination calculation by using the at least one final selection model to obtain comprehensive price parameters of the power grid project equipment material. According to the price parameter generation method and device of the power grid project equipment material provided by the invention, as a plurality of influence factors and a plurality of indexes of the price of the power grid project equipment material are comprehensively considered, compared with the traditional simple price statistical approach, the generated comprehensive price parameters are more accurate, and the price prediction risks of enterprises are reduced.

Owner:GRID POWER PLANNING & RES CENT OF GUANGDONG GRID POWER CO LTD +1

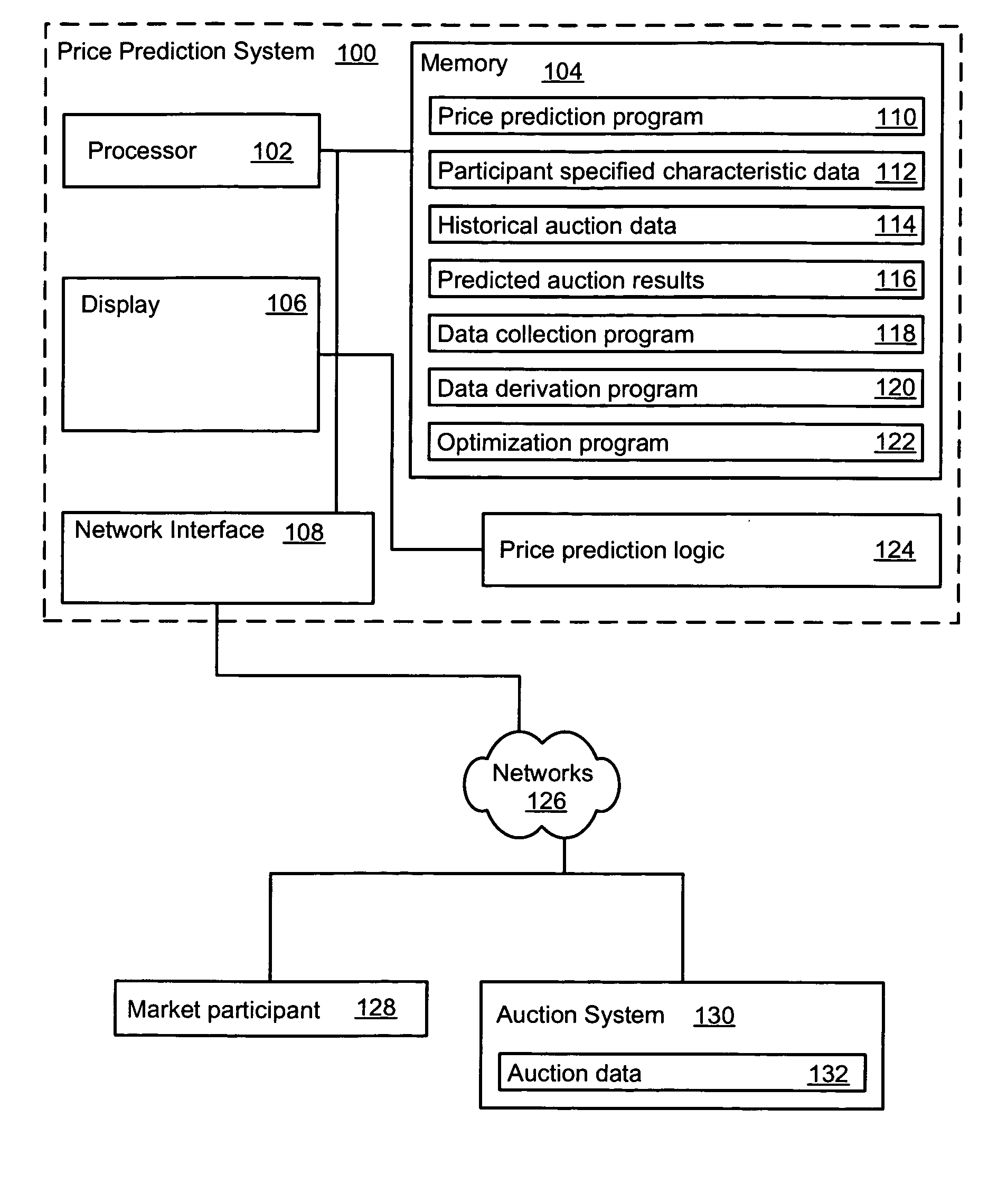

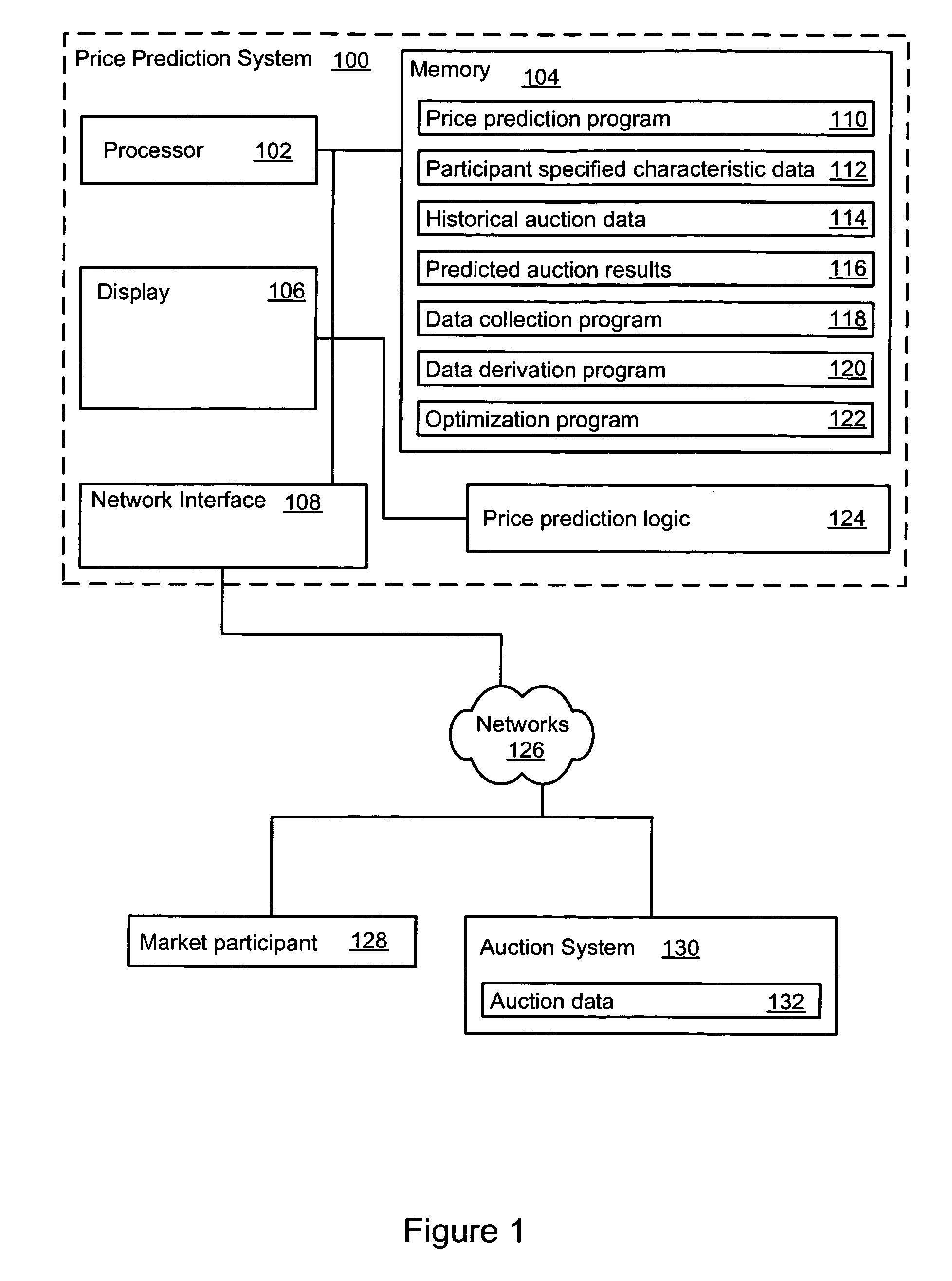

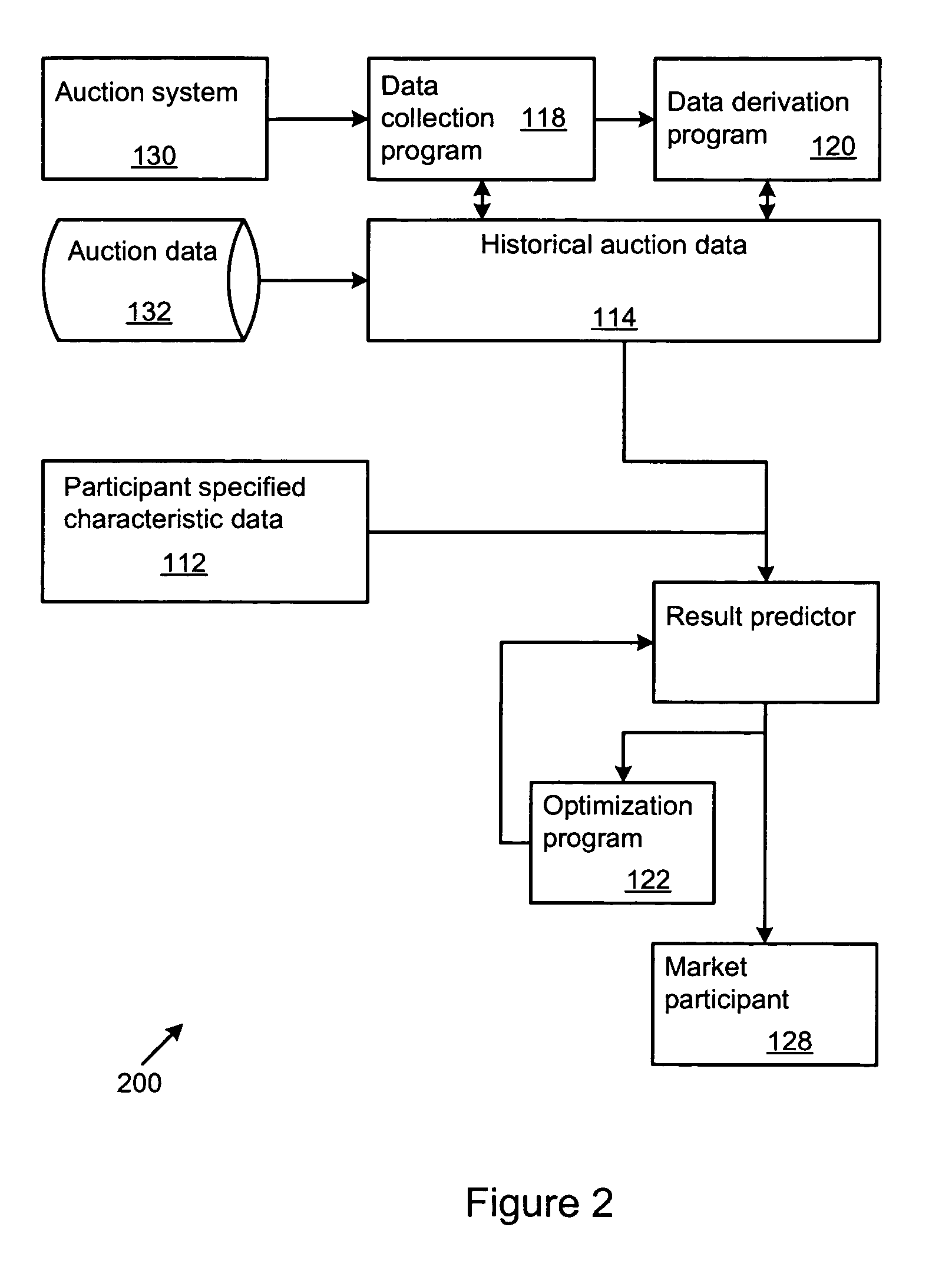

Auction result prediction

An auction analysis system predicts auction results. The analysis system may determine item, seller, or auction characteristics from prior or pending auctions. The analysis system also obtains item characteristics of an item for which a result prediction is sought, either by a buyer or by a seller. A price predictor in the system accepts the auction and item characteristics and predicts an auction result based on the characteristics.

Owner:ACCENTURE GLOBAL SERVICES LTD

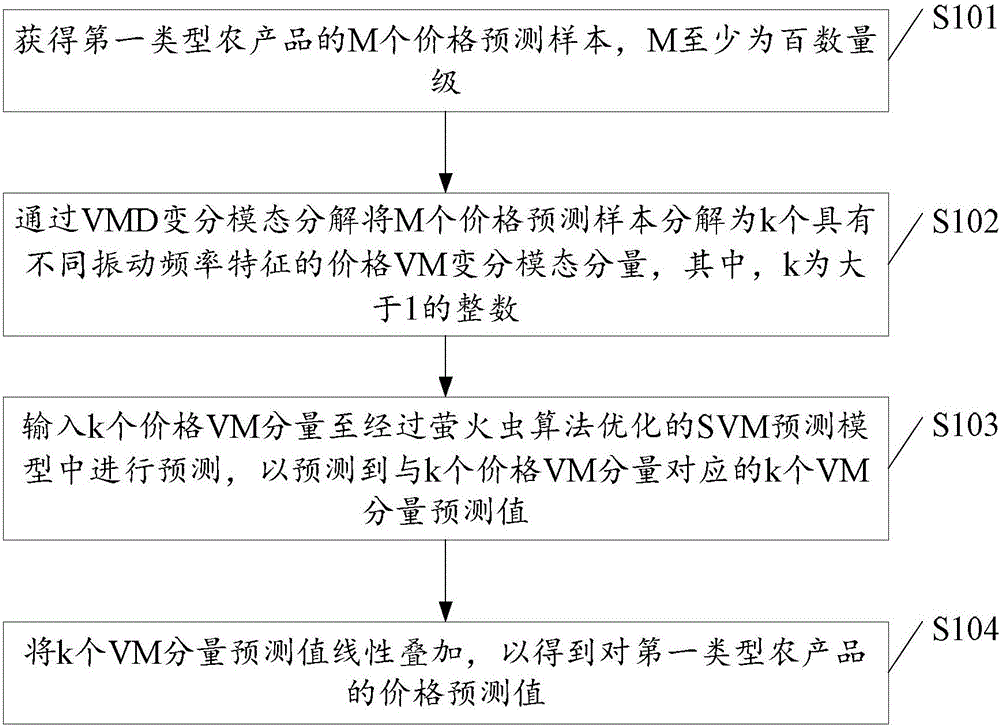

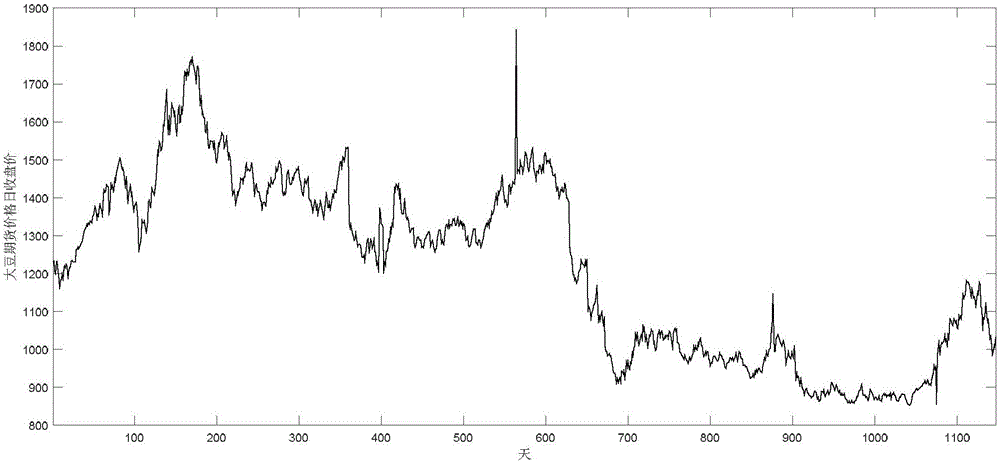

Agricultural product price prediction method and apparatus

InactiveCN106651464AImprove forecast accuracyReduce instabilityMarketingInformation processingVariational mode decomposition

The invention discloses an agricultural product price prediction method and apparatus, which is applied to the field of information processing. The method comprises the steps of obtaining M price prediction samples of a first type of agricultural product, wherein M is at least one hundred; decomposing the M price prediction samples into k price VM (Variational Mode) components with different vibration frequency features through VMD (Variational Mode Decomposition), and inputting the k price VM components to an SVM prediction model optimized through a firefly algorithm to perform prediction, thereby obtaining k VM component prediction values corresponding to the k price VM components; and linearly superposing the k VM component prediction values to obtain a price prediction value of the first type of agricultural product. Through the method and the apparatus, the price prediction precision of the agricultural product is improved.

Owner:CHINA UNIV OF GEOSCIENCES (WUHAN)

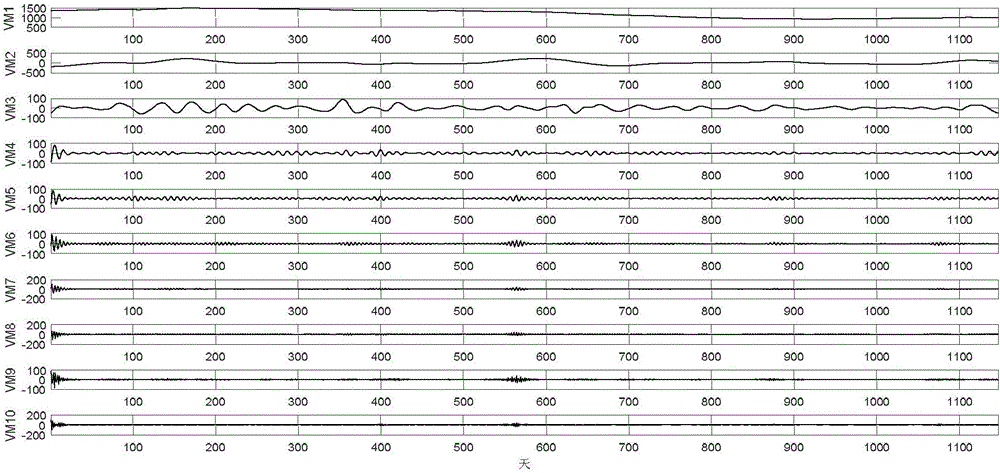

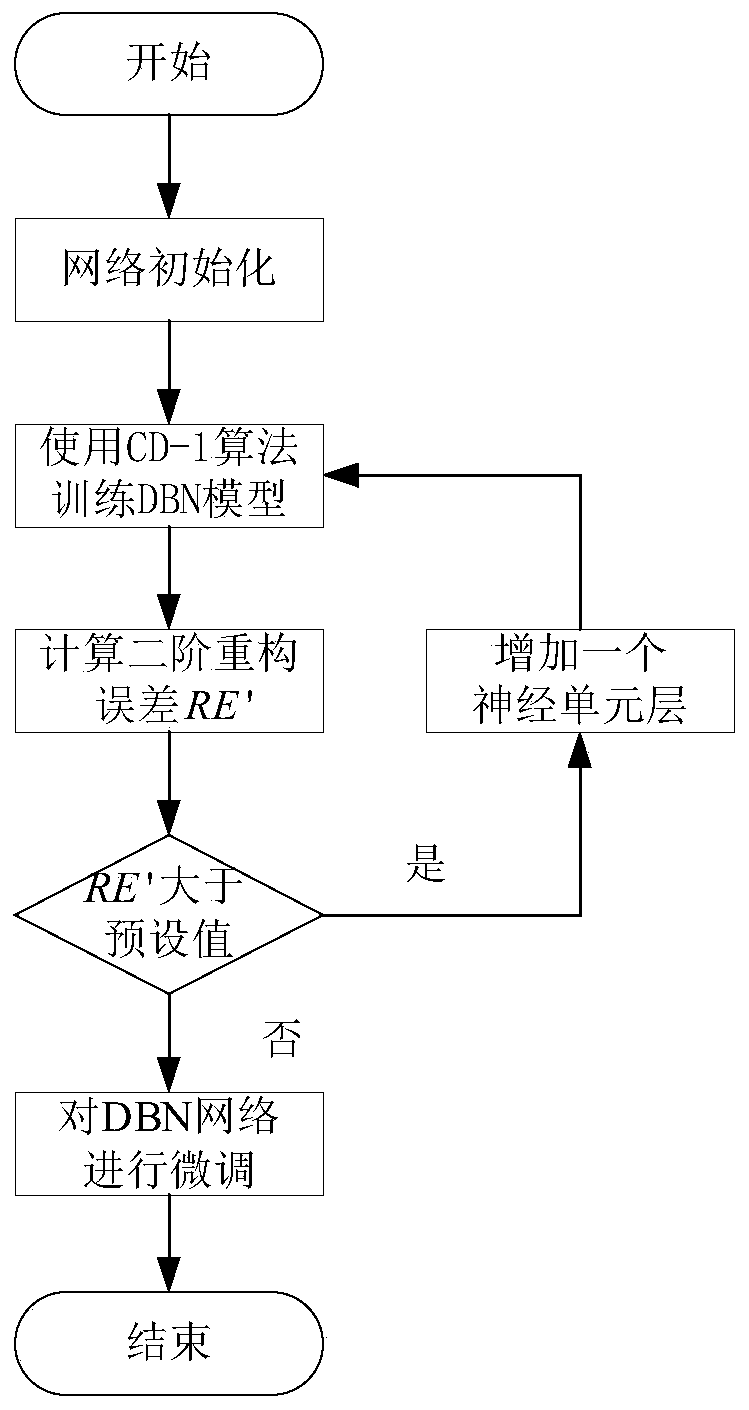

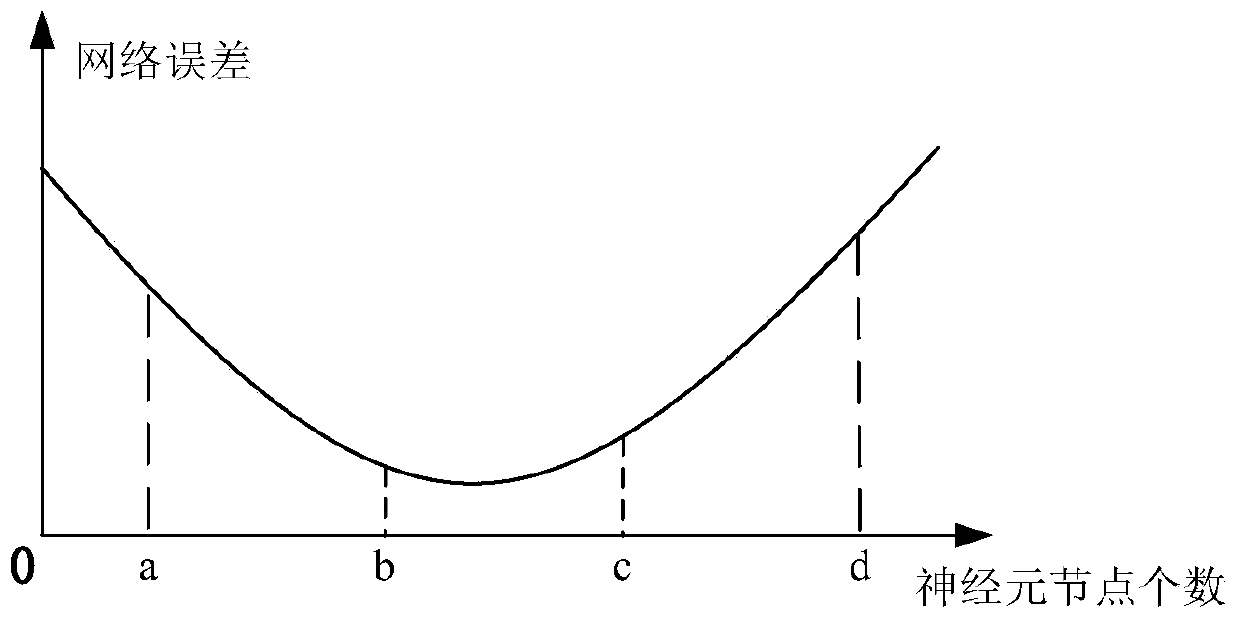

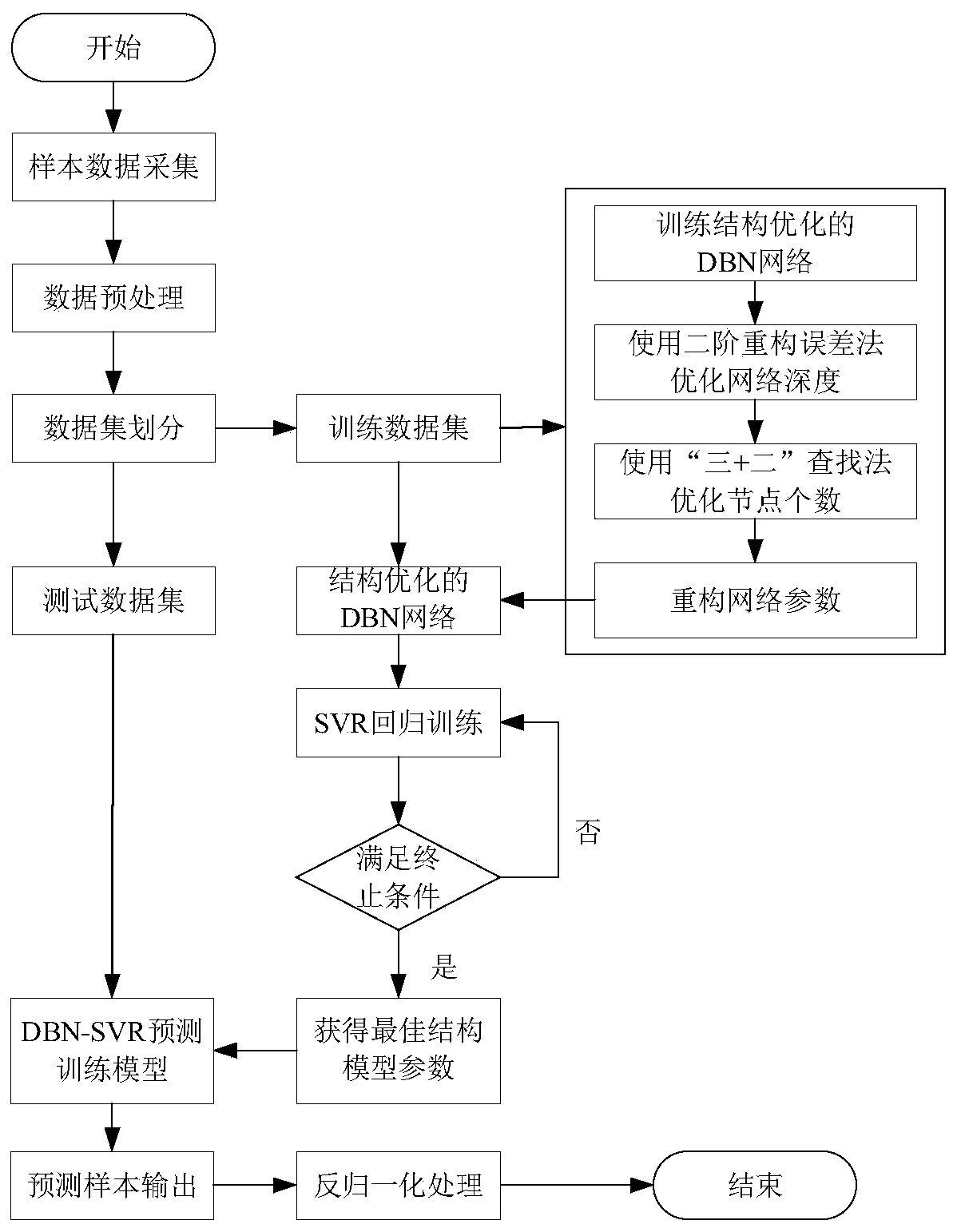

Power price prediction method based on improved deep belief network

InactiveCN110009160AOptimize network structureImprove forecast accuracyMarket predictionsForecastingDeep belief networkNODAL

The invention discloses a power price prediction method based on an improved deep belief network, and the method comprises the steps: dividing a data set and determining the input of network data according to the characteristics of electricity price data and the influence factors of electricity price, and carrying out the data preprocessing of an adopted data set; for the preprocessed data set, calculating a network error by using a second-order reconstruction error, and determining the number of layers of the model RBM; optimizing the number of neuron nodes in the network by using a '3 + 2 'search algorithm combining a trisection method and a bisection method; using a BP neural network and an SVR support vector regression machine used as regression layers of a DBN network, and using the number of layers of an RBM and the number of optimized neuron nodes to construct a DBN-BP model with an optimized structure and the DBN-SVR model with an optimized structure; and predicting the real-time electricity price data. According to the invention, the DBN model with an optimized structure is established, and different combination improvements are carried out on the regression layer of the network, so that the prediction precision of the DBN is improved, and the application prospect is very good.

Owner:NORTHEASTERN UNIV

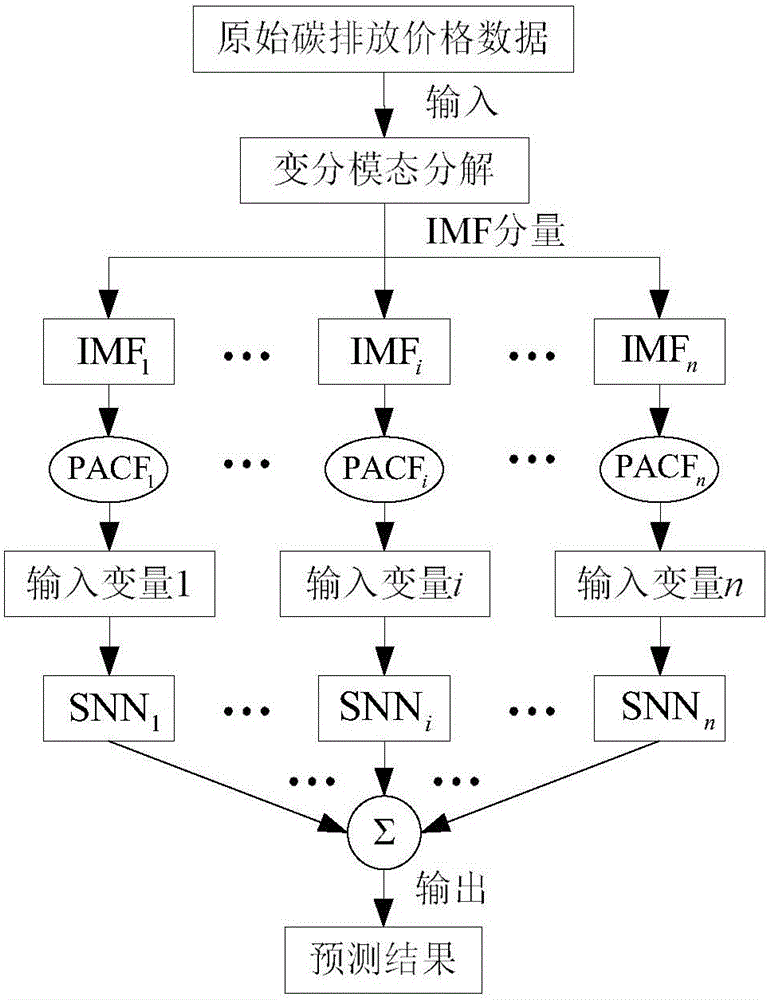

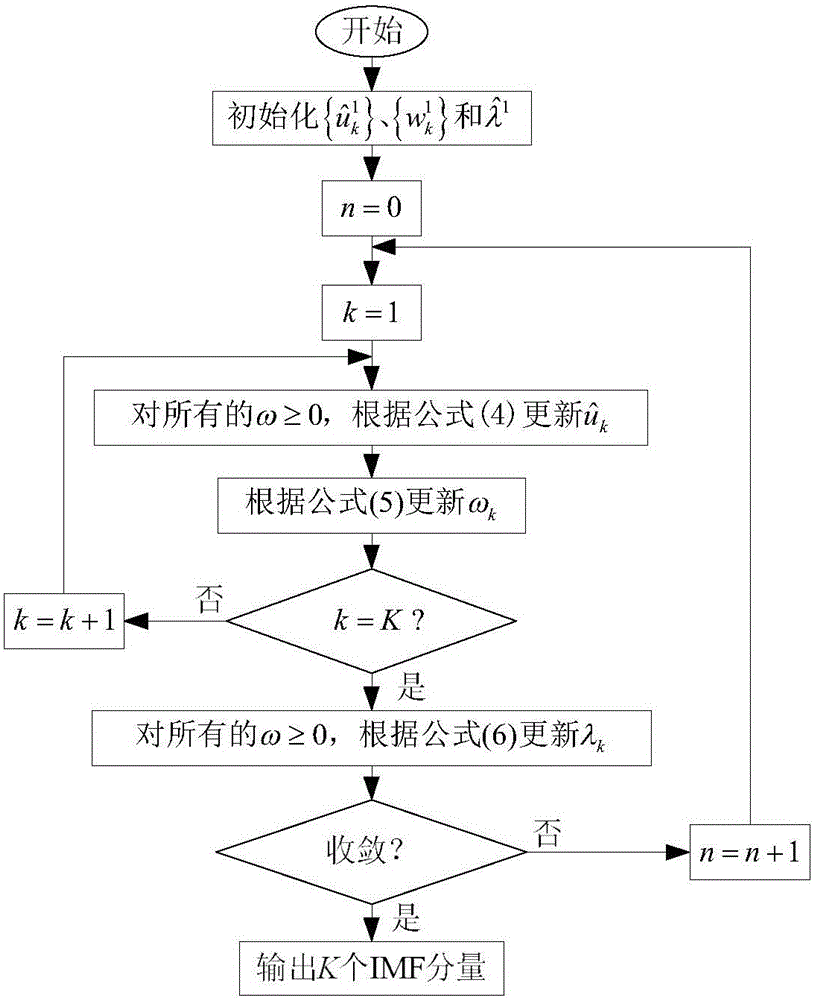

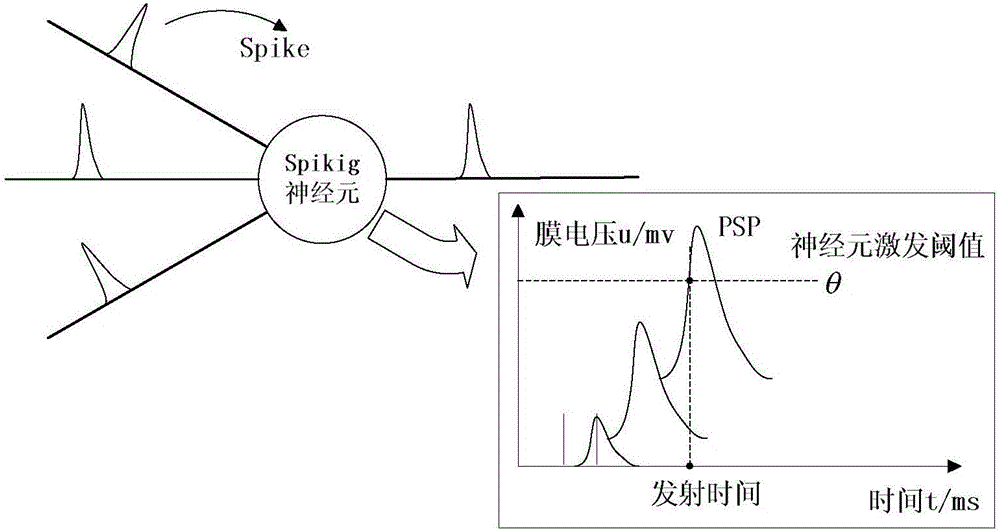

Carbon emission price combination prediction method

InactiveCN105160204AImprove accuracyGood noise robustnessSpecial data processing applicationsDecompositionAlgorithm

The invention discloses a carbon emission price combination prediction method. The method includes the steps that 1, an original carbon emission price sequence is decomposed into a series of intrinsic function components through a variation mode decomposition algorithm; 2, an output variable is given, the input variable of each IMF component is determined through statistical tools comprising a partial autocorrelation function and a corresponding partial autocorrelation diagram thereof; 3, each IMF component is predicted through a Spiking neural network; 4, prediction results of all the IMF components are superimposed to obtain a predicted value corresponding to an original carbon emission price. By means of the method, prediction precision is effectively improved, and carbon emission price prediction can be well achieved.

Owner:HOHAI UNIV

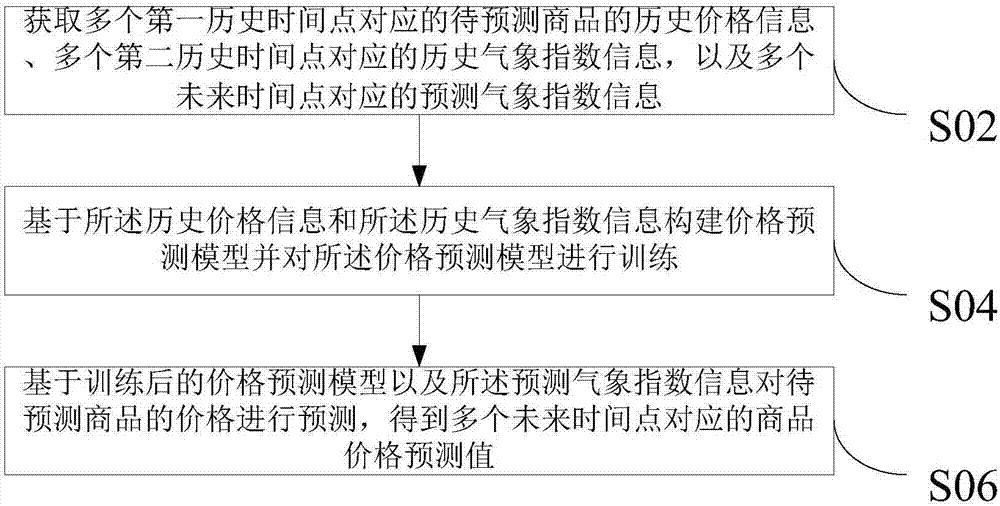

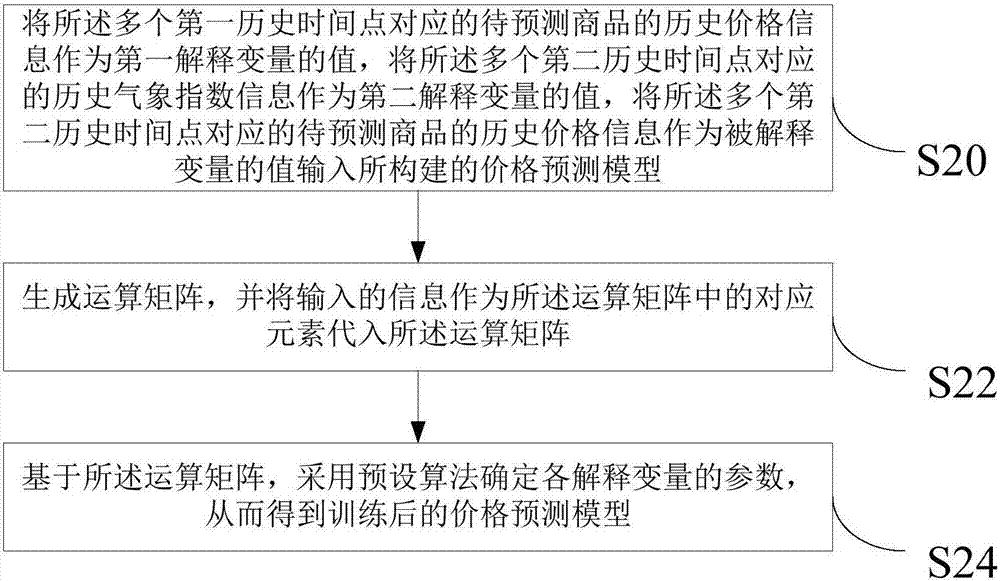

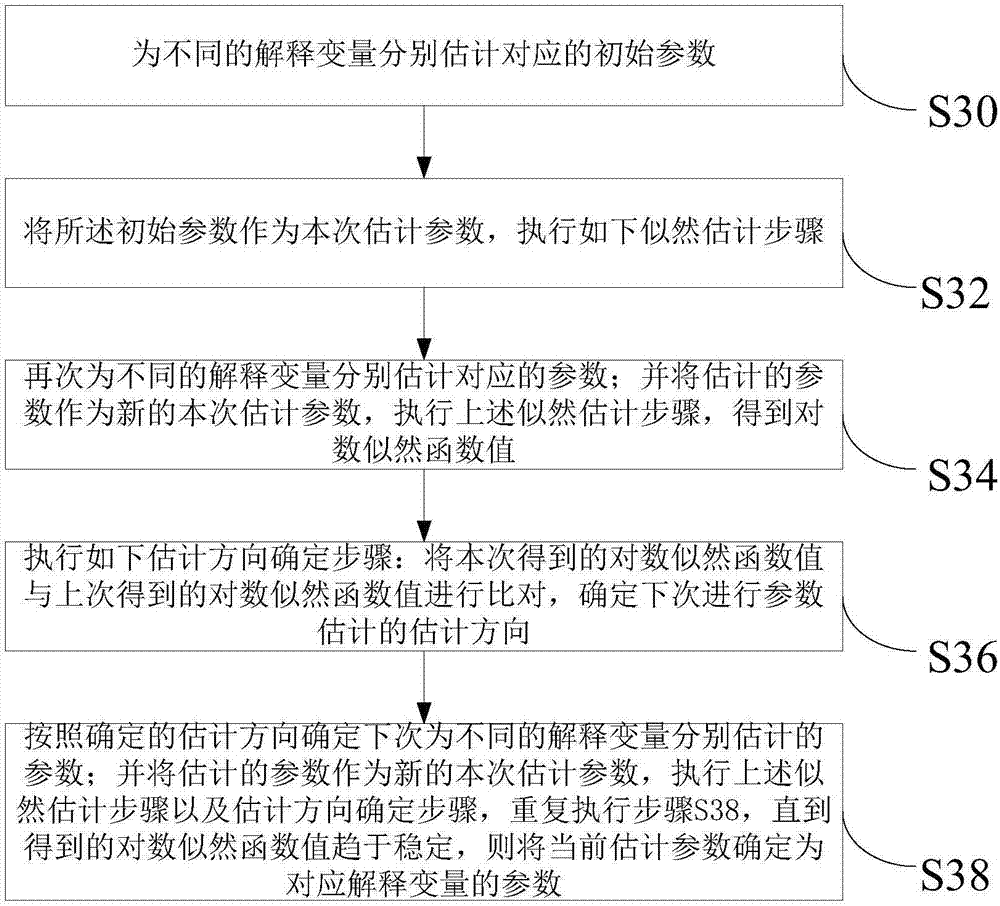

Prediction method and device of commodity price

InactiveCN107369049AIncrease credibilityReduce calculation errorsMarketingEarly predictionCalculation error

The present invention provides a commodity price prediction method and device, the method comprising: acquiring historical price information of commodities to be predicted corresponding to multiple first historical time points, historical weather index information corresponding to multiple second historical time points, and Forecast weather index information corresponding to multiple future time points; build a price prediction model based on historical price information and historical weather index information and train the price prediction model; treat the price of the forecast commodity based on the trained price prediction model and forecast weather index information Forecasting is performed to obtain forecasted commodity price values corresponding to multiple future time points. In the embodiment of the present invention, by adding an anchor factor that can predict the trend in advance in the price prediction model, instead of relying on the explained variable itself to calculate the later prediction based on the previous prediction, the calculation error is reduced, thereby improving the price prediction model. Confidence in long-term forecasts.

Owner:GUOXIN YOUE DATA CO LTD

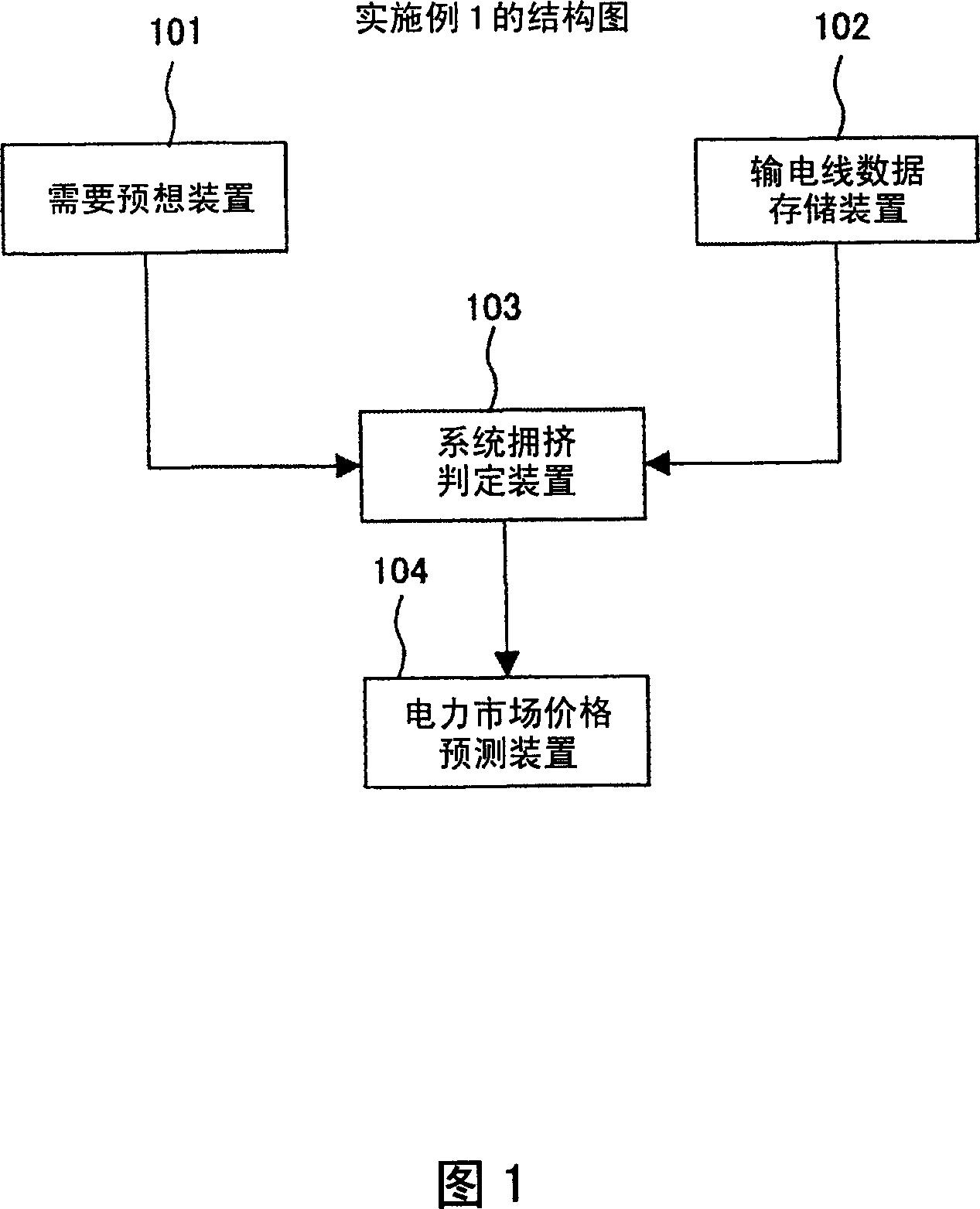

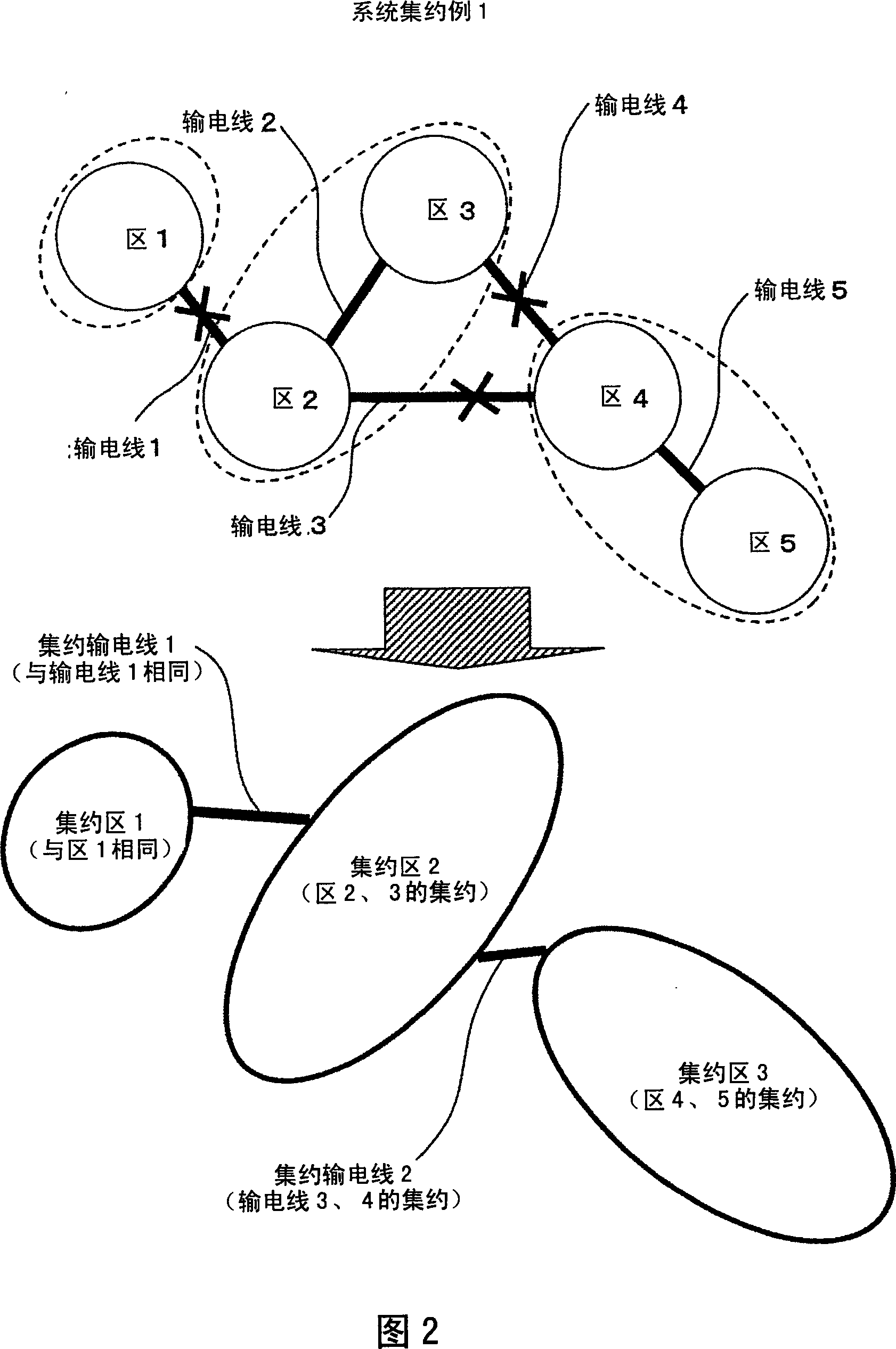

Pretest system for market price of electric power

InactiveCN1959715ASimple predictionCommerceInformation technology support systemSupporting systemElectricity pricing

Owner:HITACHI LTD

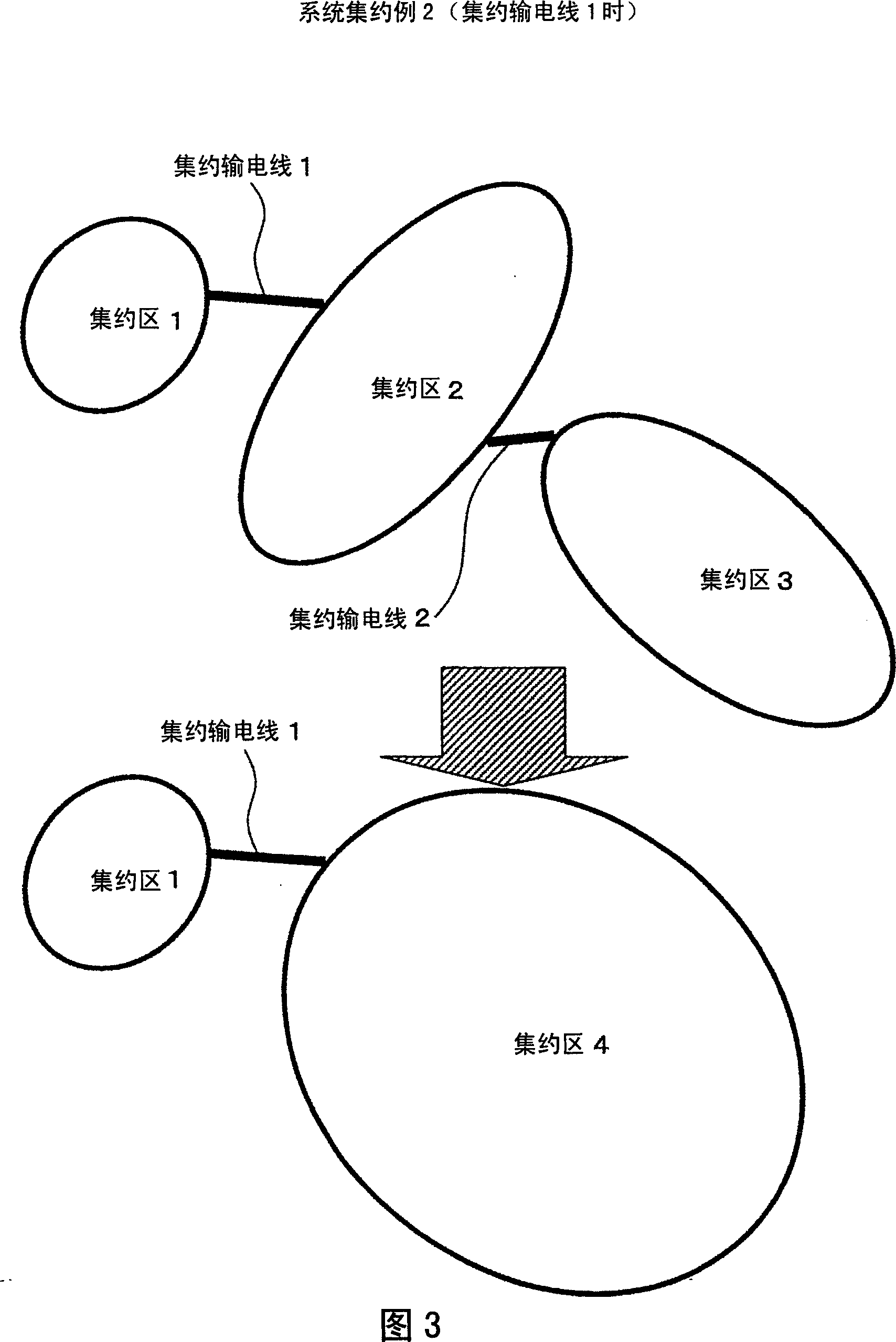

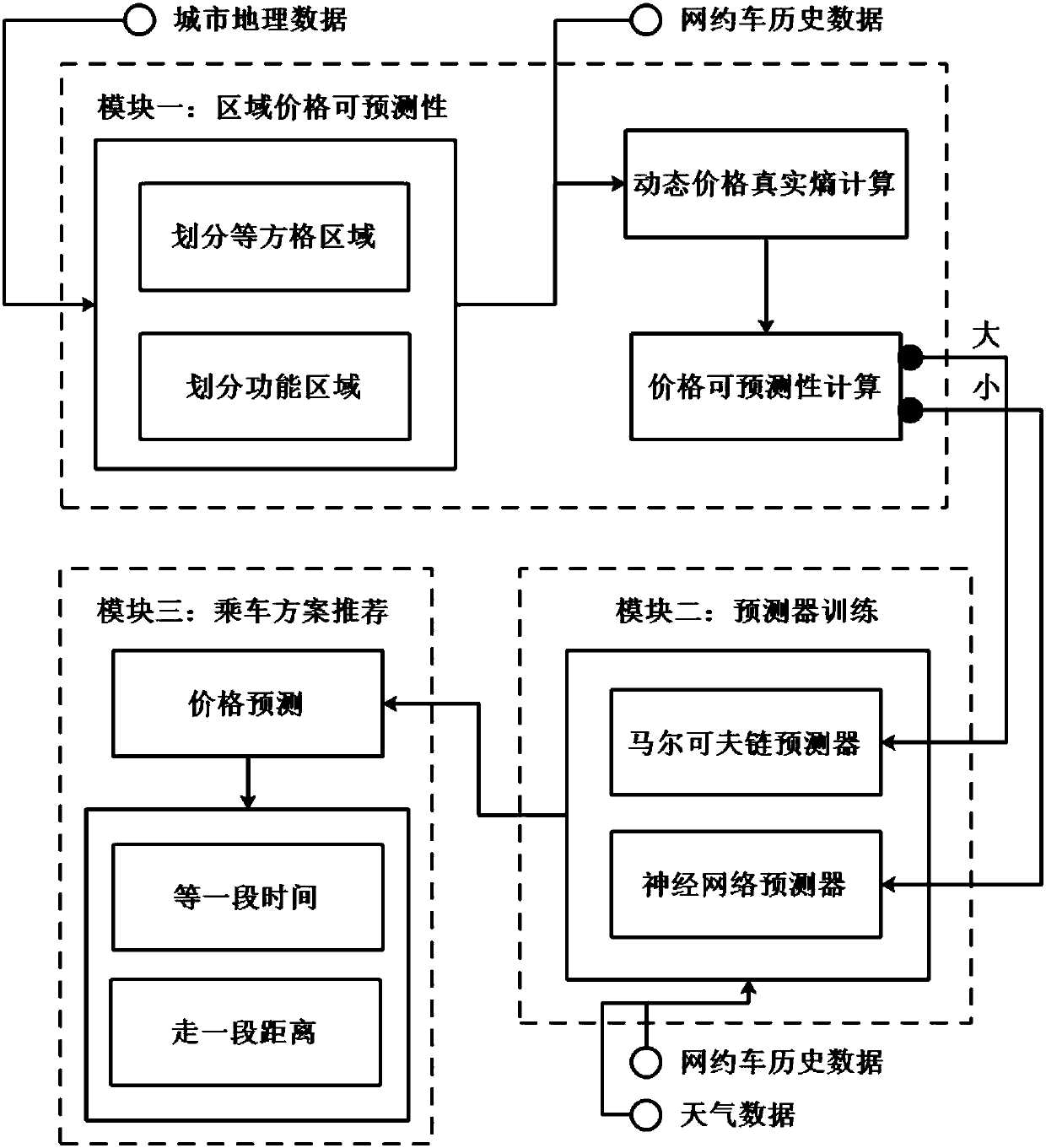

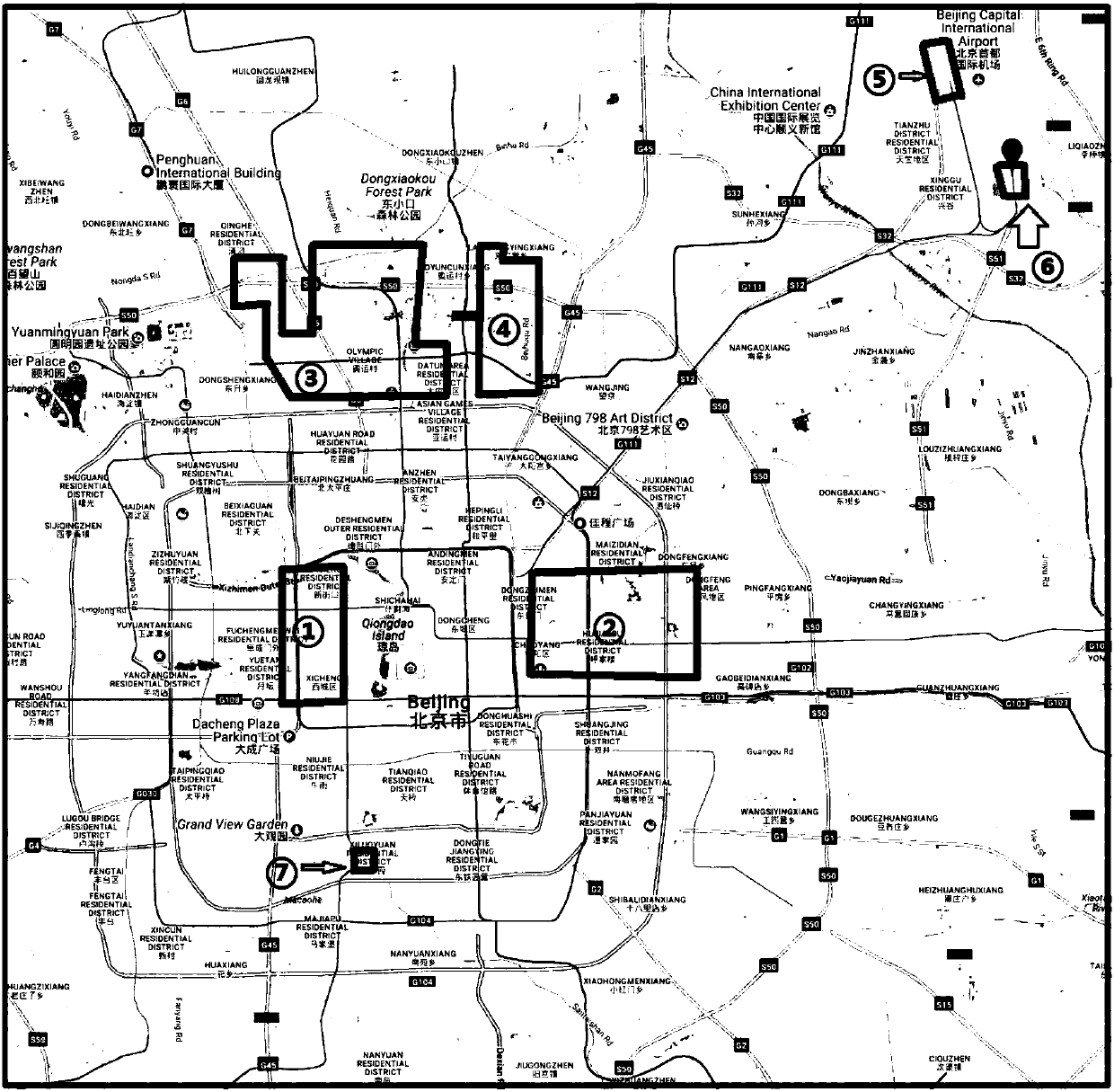

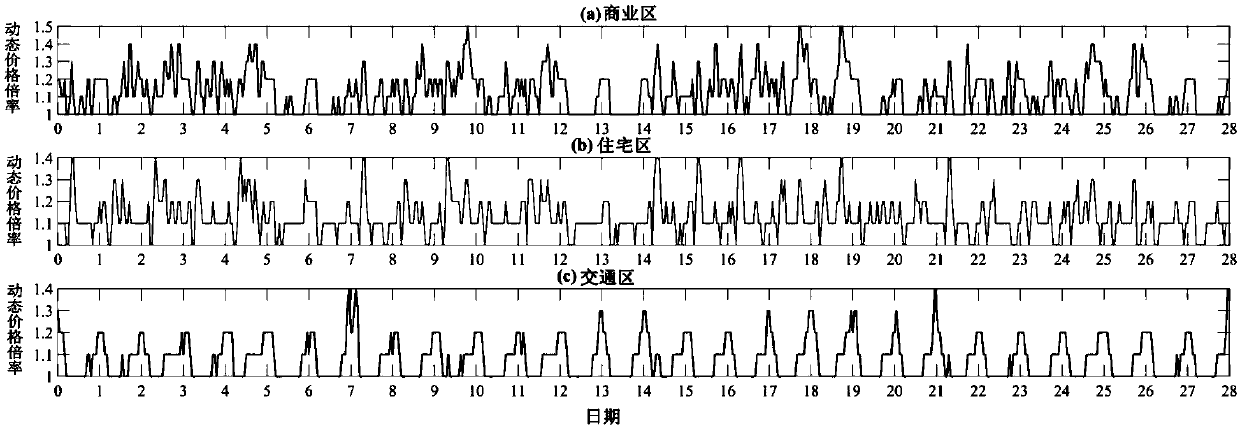

Riding recommendation system for reducing online car-hailing expenses by dynamic price prediction

The invention discloses a riding recommendation system for reducing online car-hailing expenses by dynamic price prediction, and provides journey expense prediction to recommend a riding scheme with few riding expenses by aiming at the online car-hailing riding requirements of a user at a certain time and place in a city. The method comprises the following steps that: the system subdivides the city into a plurality of areas and uses an entropy and a Fano inequation to calculate the dynamic price predictability of an area; then, the system selects a Markov chain predictor or a neural network predictor to carry out dynamic price prediction by aiming at areas of different predicable sizes; and finally, the system predicts the riding expenses and recommends a riding scheme with reduced expenses, for example, the user can obtain lower riding price if the user waits for a period of time in situ or moves for a distance. An experiment result indicates that the prediction result of the system is roughly matched with survey data, so that the user reduces anxiety generated due to uncertain riding expenses, and travel expenditures are saved.

Owner:CHONGQING UNIV

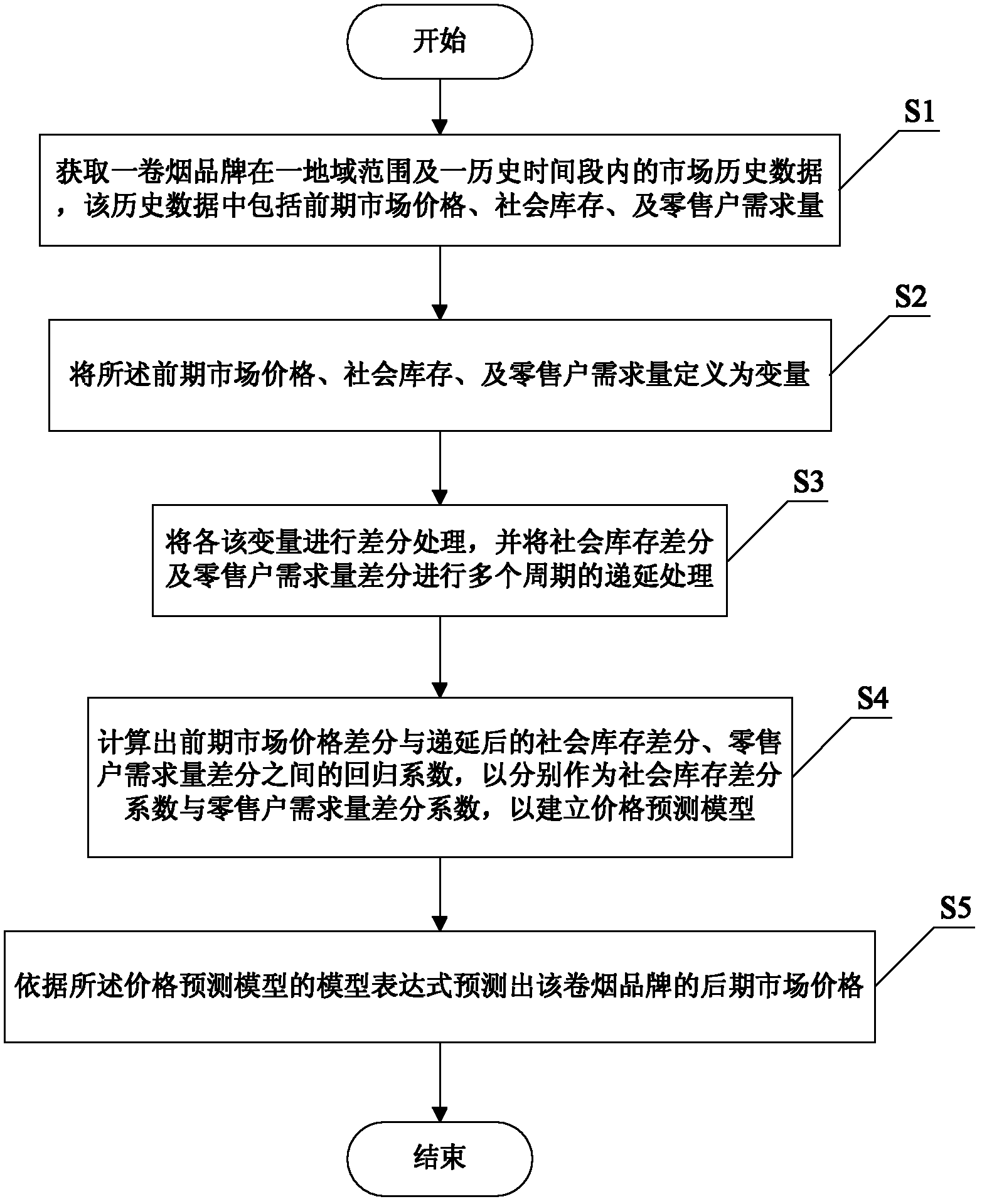

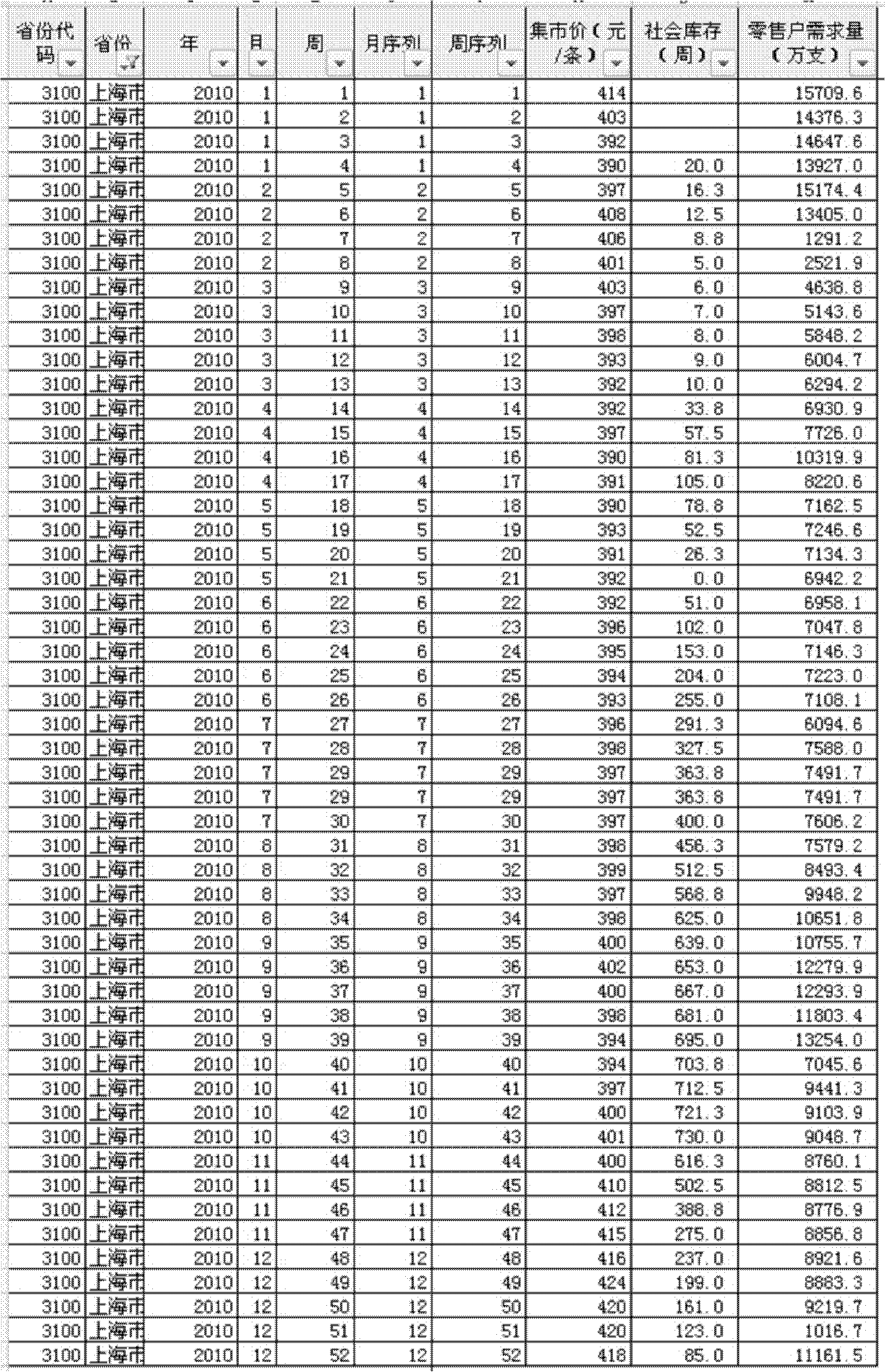

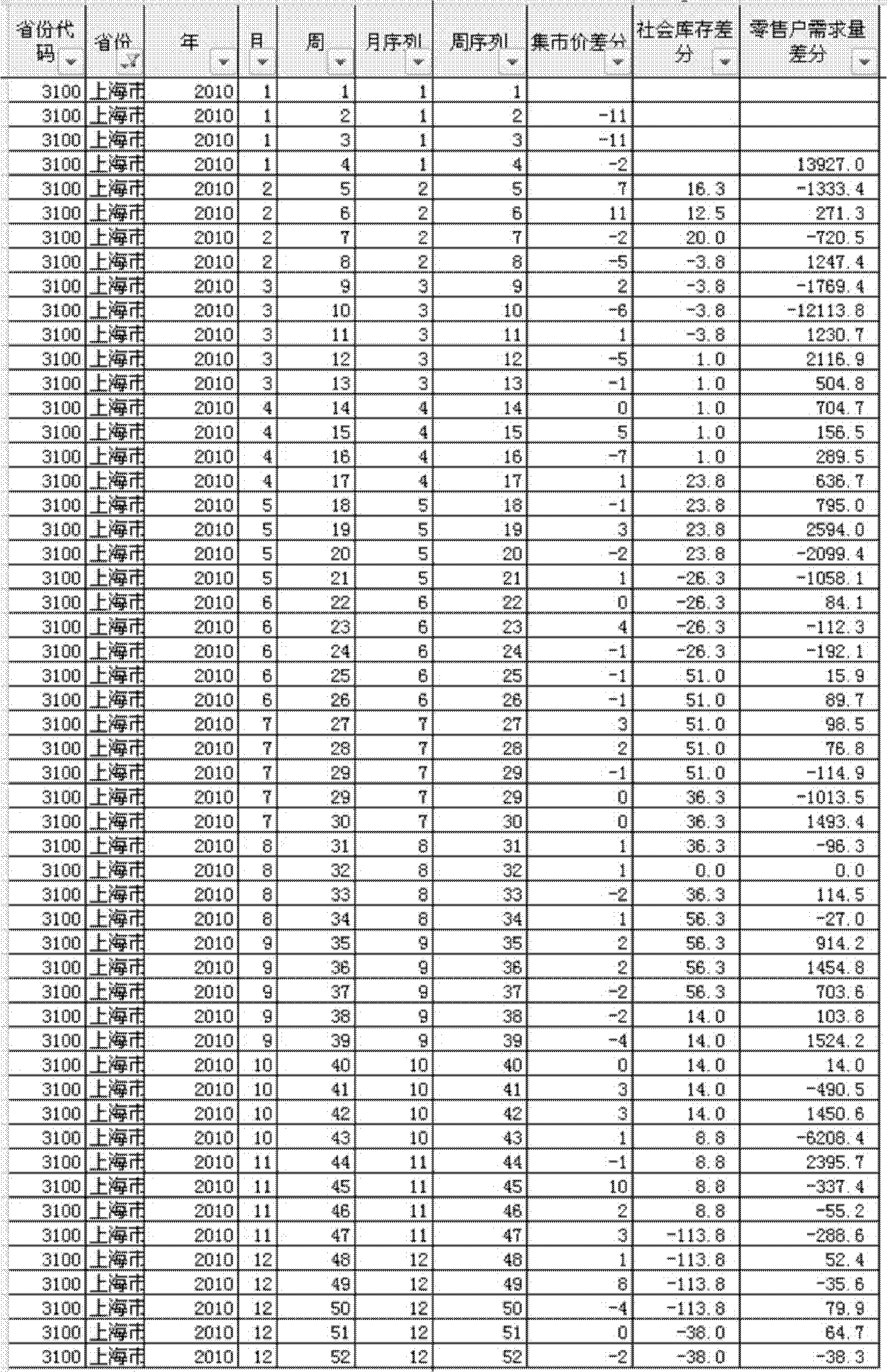

Cigarette market price prediction method based on multiple linear regression

InactiveCN102324082AEasy to controlAccurate predictionCommerceMultiple linear regression analysisLinear regression

The invention provides a cigarette market price prediction method based on multiple linear regression, comprising the following steps of: firstly, acquiring market historical data of a cigarette brand within a territorial scope and a historical time period, then defining early market price, social inventory and demanded quantity of retailers in the data as variables, carrying out difference treatment on each variable, and carrying out deferring treatment for multiple periods on a social inventory difference and a demanded quantity difference of the retailers; next, calculating a regression coefficient among an early market price difference, a deferred social inventory difference and the demanded quantity difference of the retailers to create a price prediction model; and finally, predicating the later market price of the cigarette brand according to the model expression of the price prediction model so as to accurately predicate the market price of a cigarette and further help a manager better control a cigarette market.

Owner:SHANGHAI TOBACCO GRP CO LTD

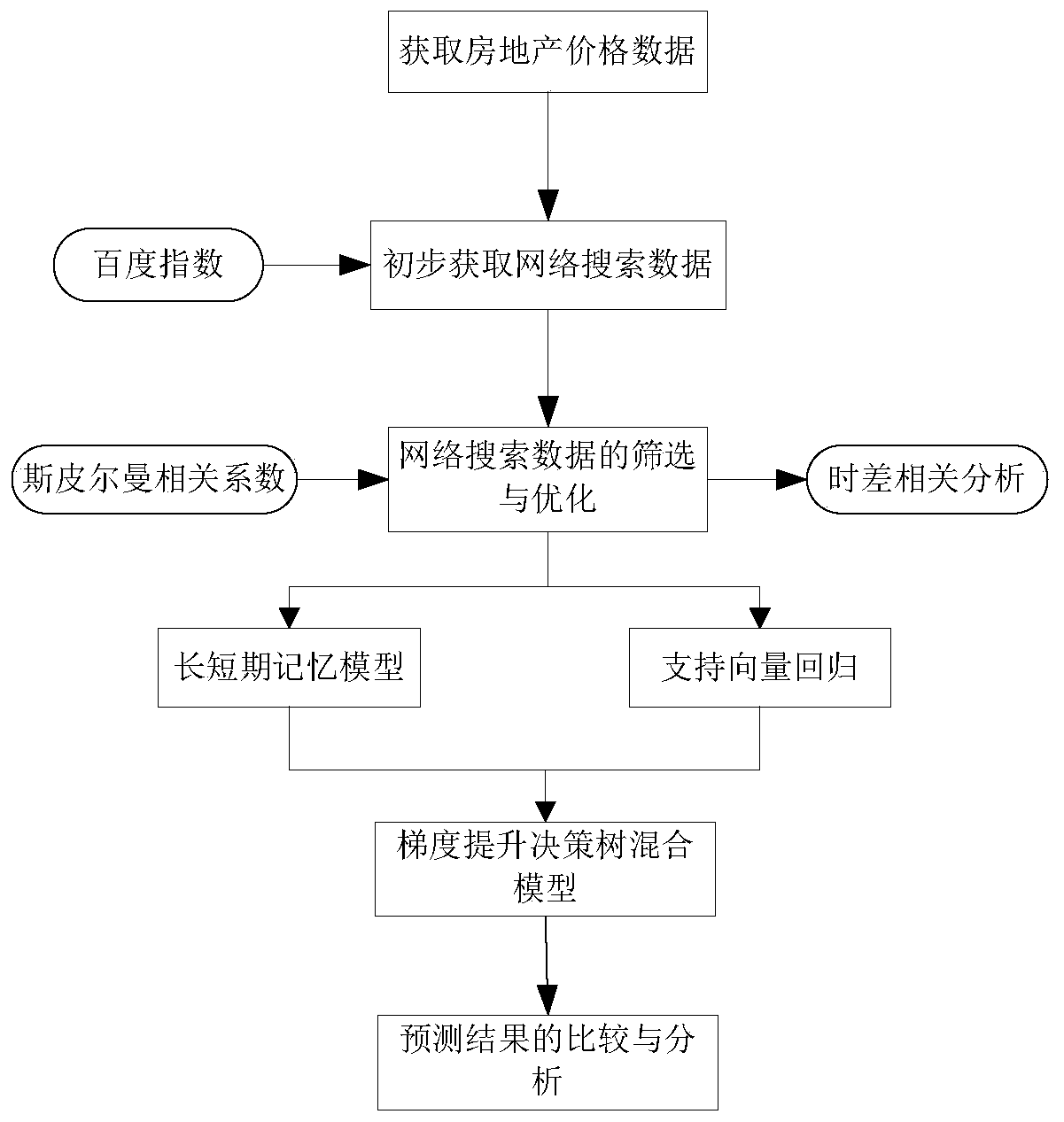

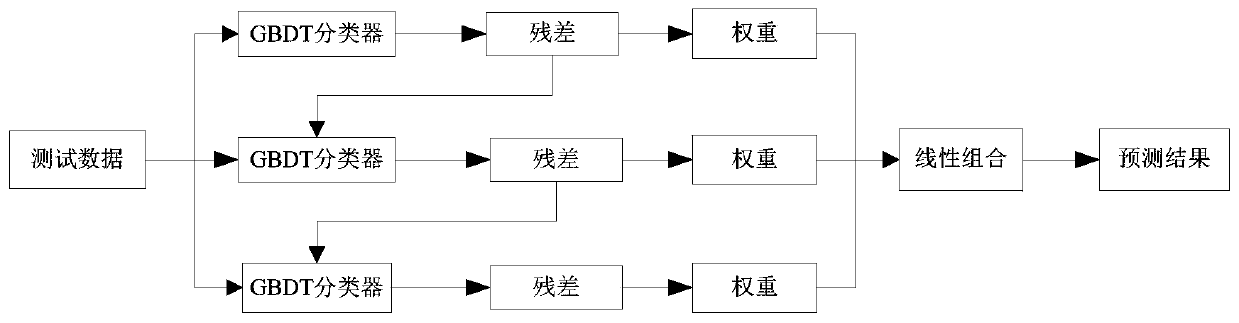

Real estate price prediction research method based on gradient boosting decision tree hybrid model

PendingCN110837921AAccurate predictionImprove accuracyMarket predictionsForecastingCorrelation coefficientAlgorithm

The invention discloses a real estate price prediction research method based on a gradient boosting decision tree hybrid model. The method comprises the following steps: 1) obtaining network search data and real estate price data; 2) screening out an advanced keyword having high correlation with the real estate price from the network search data and the real estate price data by calculating a Spearman correlation coefficient and carrying out time difference correlation analysis; 3) establishing a long-term and short-term memory model, and predicting the real estate price through the long-termand short-term memory model; 4) establishing a support vector regression model, and predicting the real estate price by using the support vector regression model; and 5) taking the predicted value ofthe real estate price obtained in the step 3) and the predicted value of the real estate price obtained in the step 4) as an original sample set of the gradient boosting decision tree hybrid model, and performing prediction fusion by utilizing the gradient boosting decision tree hybrid model. The real estate price prediction method can accurately predict the real estate price.

Owner:XI'AN UNIVERSITY OF ARCHITECTURE AND TECHNOLOGY

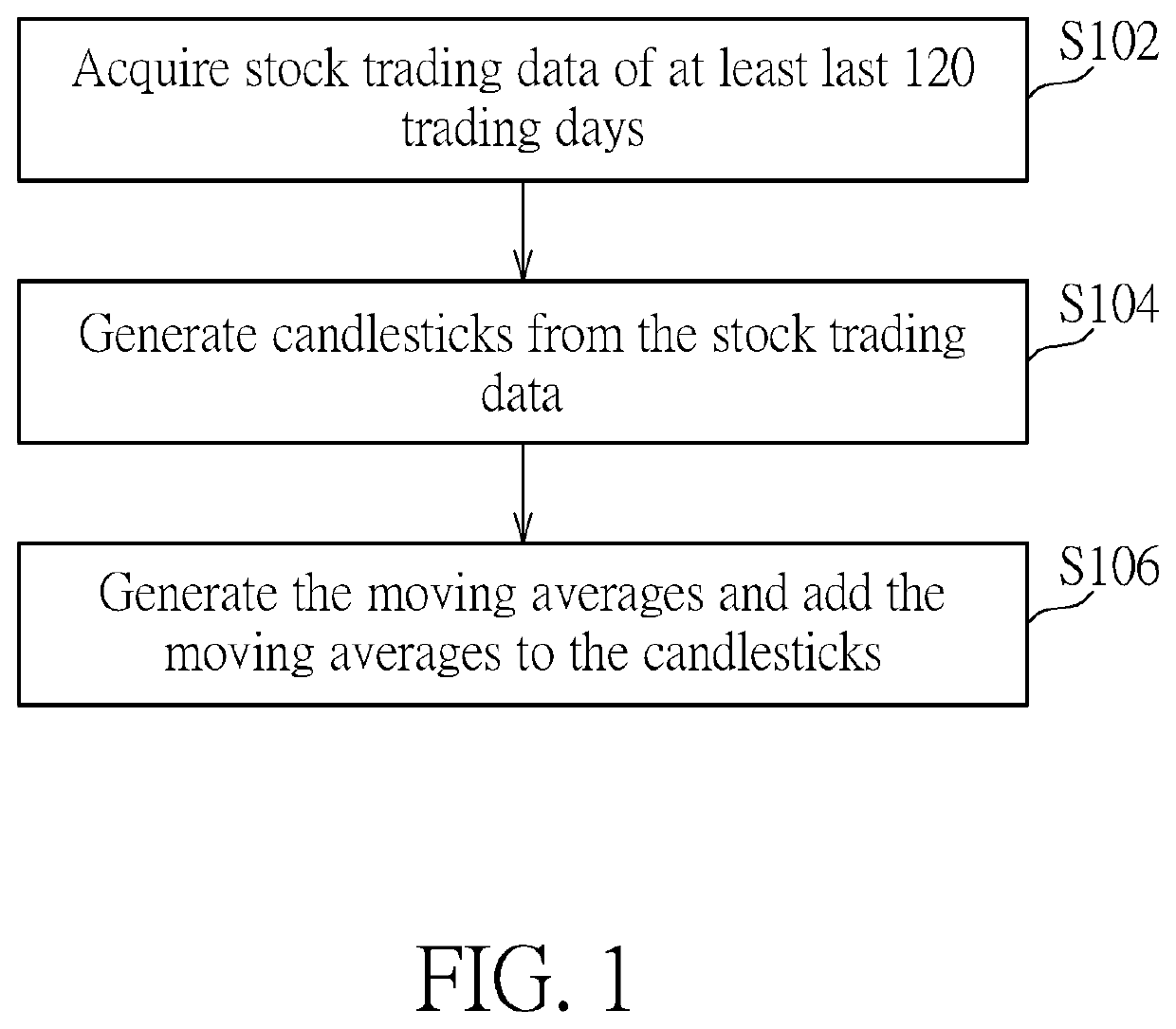

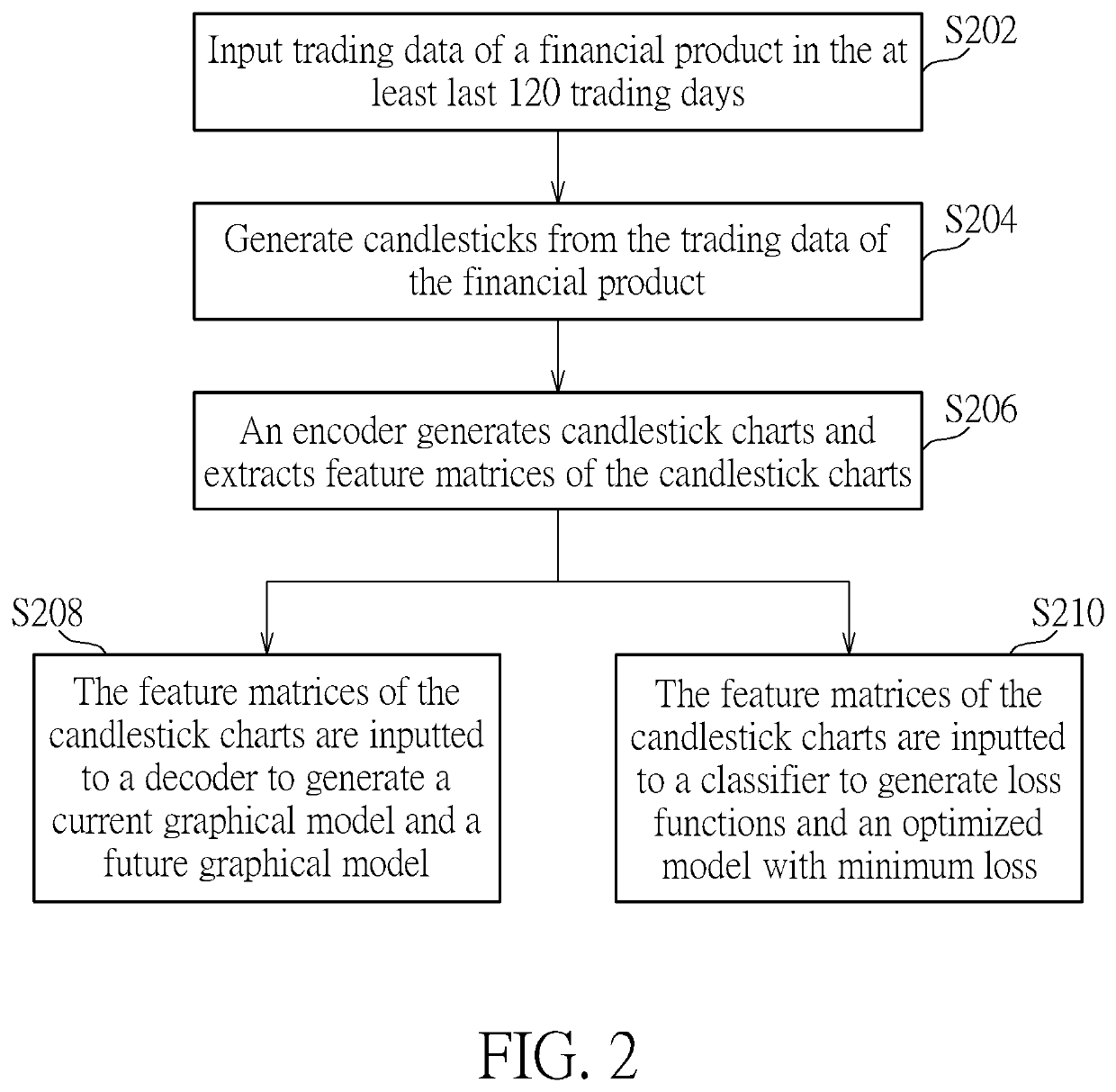

Method for price prediction of financial products based on deep learning model

A deep learning method for predicting at least one future price of a financial product includes generating a plurality of candlesticks over historical trading data of the financial product, inputting the plurality of candlesticks to a neural network machine, the neural network machine processing the plurality of candlesticks to generate a trained neural network model, and a neural network predicting machine predicting the at least one future price of the financial product according to the trained neural network model.

Owner:SHINE WE DEV INC

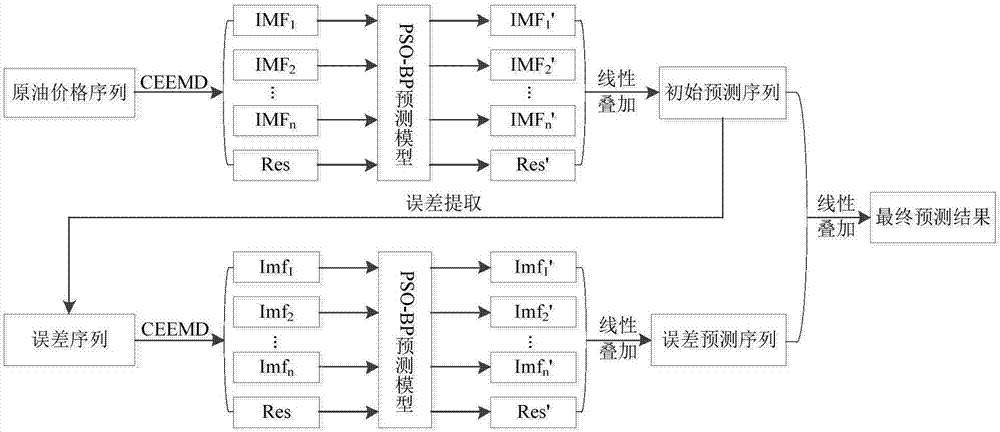

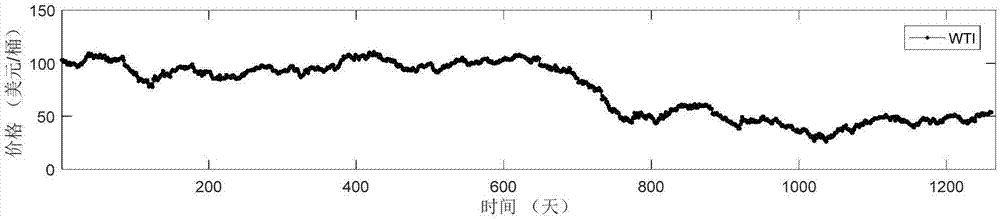

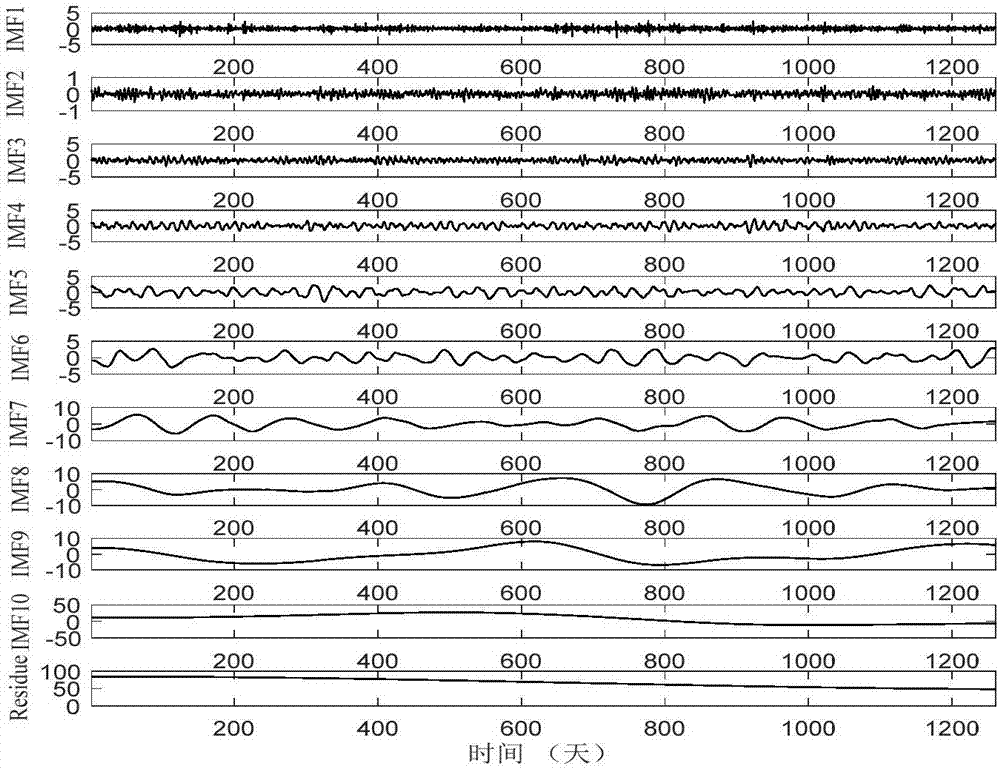

Crude oil price prediction method and system based on CEEMD-PSO-BP model and error compensation

The present invention provides a crude oil price prediction method and system based on the CEEMD-PSO-BP model and error compensation, comprising the following steps: using CEEMD to decompose the non-stationary crude oil price sequence into a series of IMF components and trend components with different frequency characteristics ;Use the PSO-BP model to predict each IMF component and trend component respectively, obtain the predicted value of each component and obtain the initial forecast sequence by linearly superimposing it; use the original crude oil price sequence to subtract the initial forecast sequence to obtain the error sequence; use CEEMD decomposes the error sequence into a series of imf components and trend components with different frequency characteristics, and uses the PSO-BP model to predict each imf component and trend component separately, obtains the predicted value of each component, and obtains the error prediction by linearly superimposing them sequence; finally, the initial forecast sequence and the error prediction sequence are linearly superimposed to obtain the final crude oil price prediction sequence. This method reduces the difficulty of crude oil price prediction and has higher accuracy.

Owner:CHINA UNIV OF GEOSCIENCES (WUHAN)

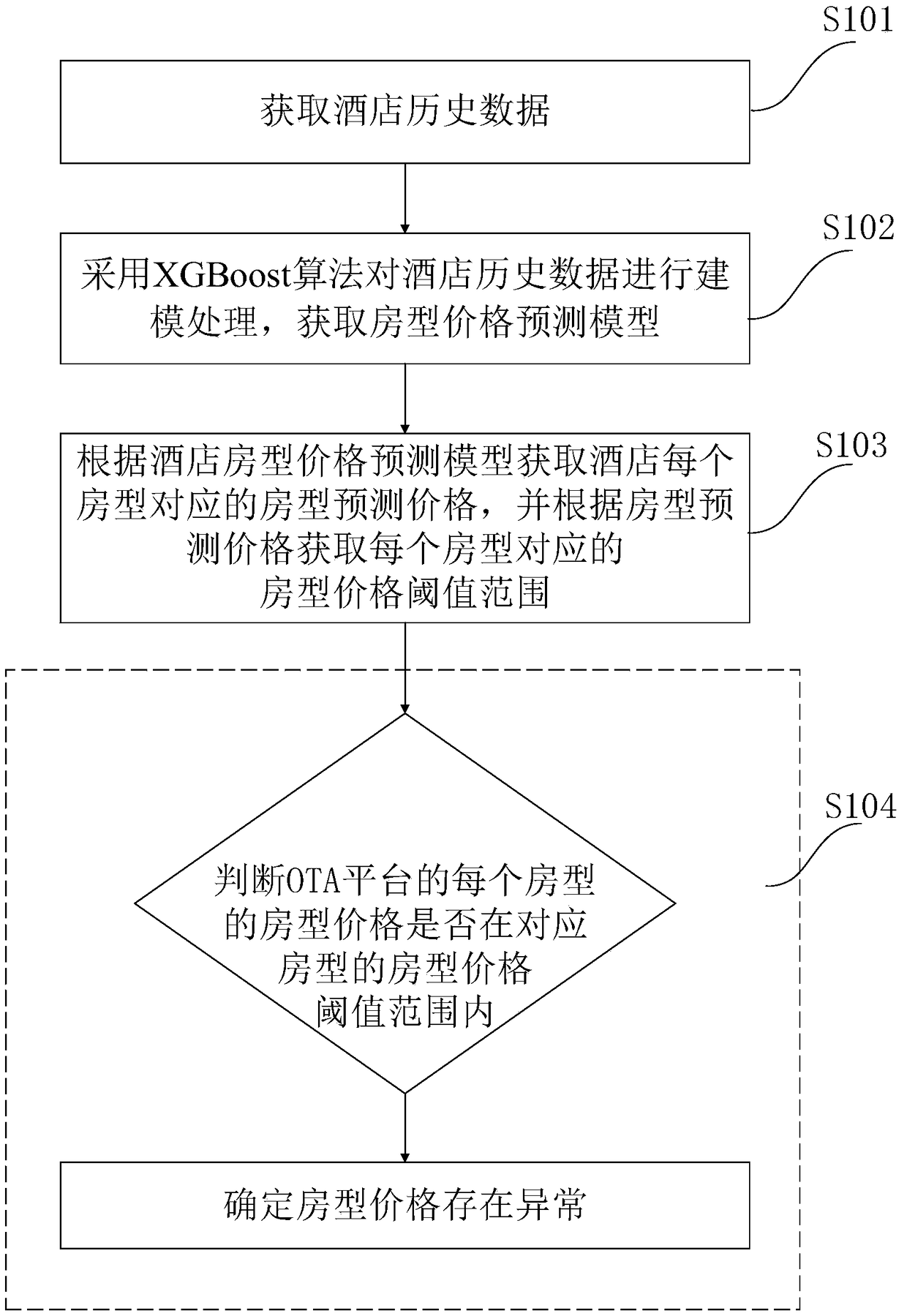

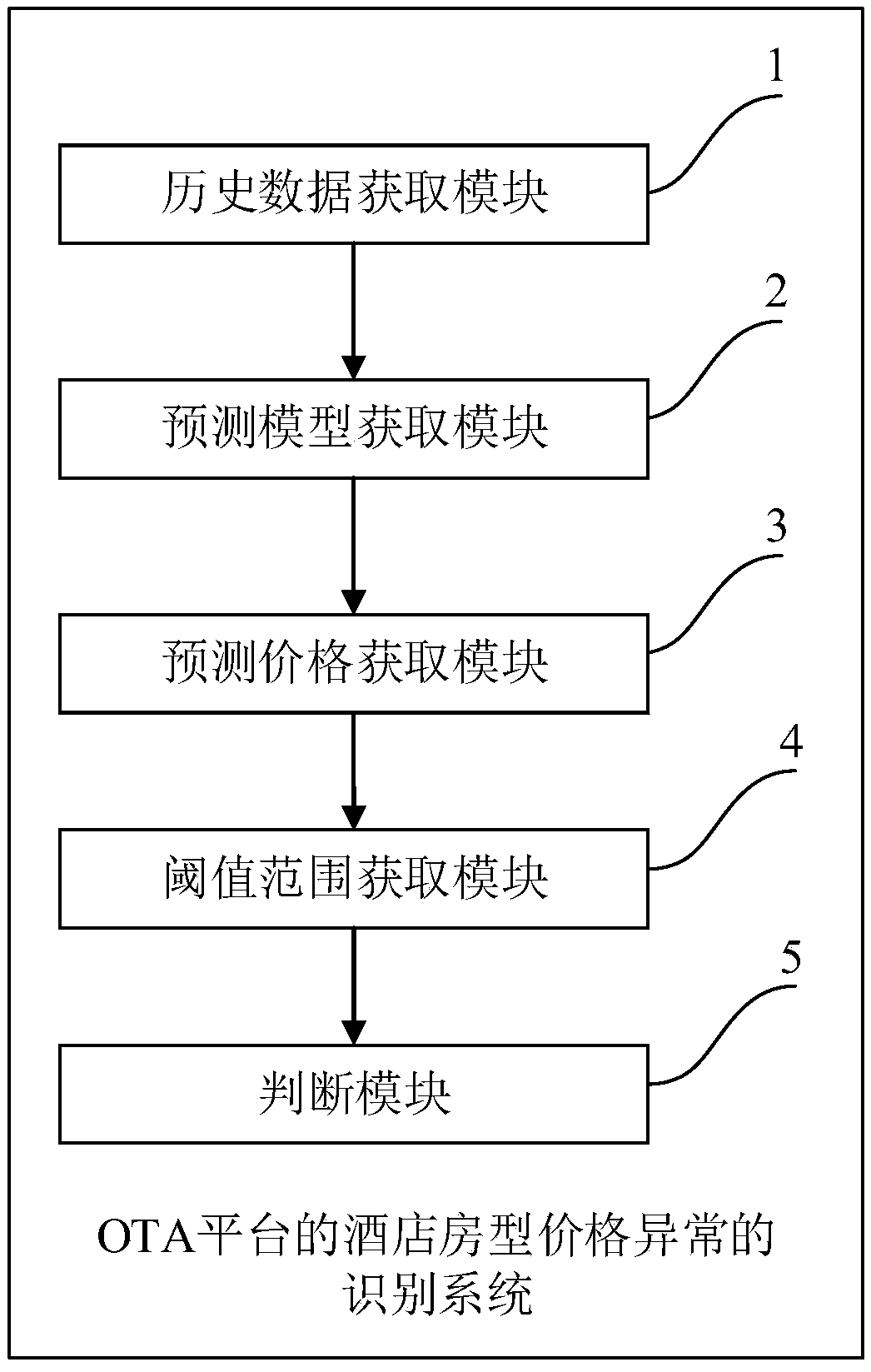

Method and system for recognizing price exceptions of hotel room types on OTA platform

The invention discloses a method and system for recognizing price exceptions of hotel room types on an OTA platform. The method comprises the following steps of: obtaining hotel history data; carryingout modeling processing on the hotel history data by adoption of an XGBoost algorithm so as to obtain a room type price prediction model; obtaining a hotel room type prediction price corresponding toeach room type of a hotel according to the room type price prediction model and obtaining a room type price threshold range corresponding to each room type; and judging whether the room type price ofeach room type on the OTA platform is in the room type price threshold range of the corresponding room type or not, and if the judging result is negative, determining that the room type price is exceptional. The method and system are capable of rapidly and effectively detecting whether the pushed room type prices are exceptional or not and preventing the pushed room type prices from entering thesystem, and detecting whether prices in the system are exceptional or not and deleting the exceptional prices, so that the exceptional prices are prevented from influencing the customer experience, enhancing the brand image, decreasing the manual business audition amount and improving the processing efficiency.

Owner:CTRIP COMP TECH SHANGHAI

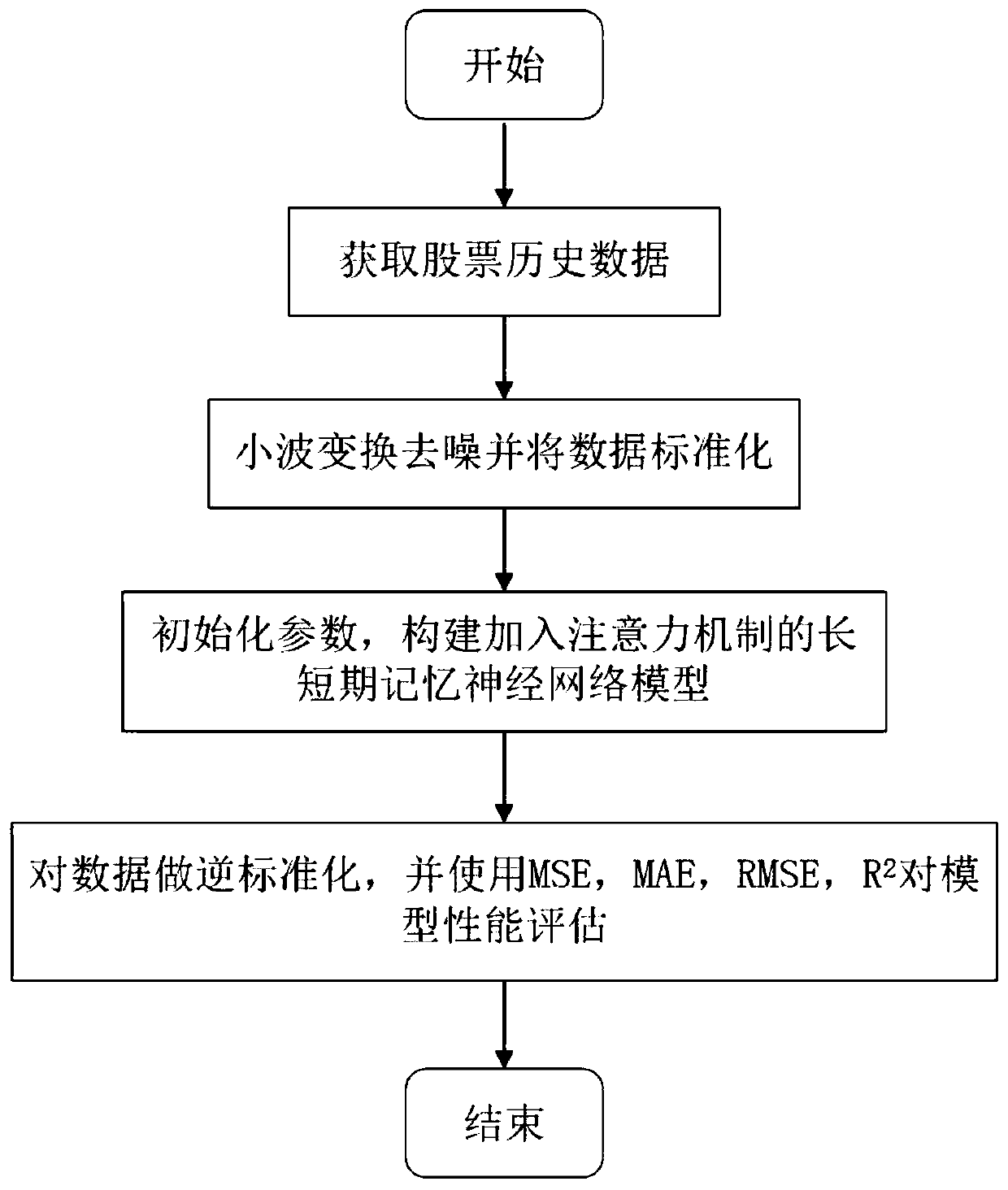

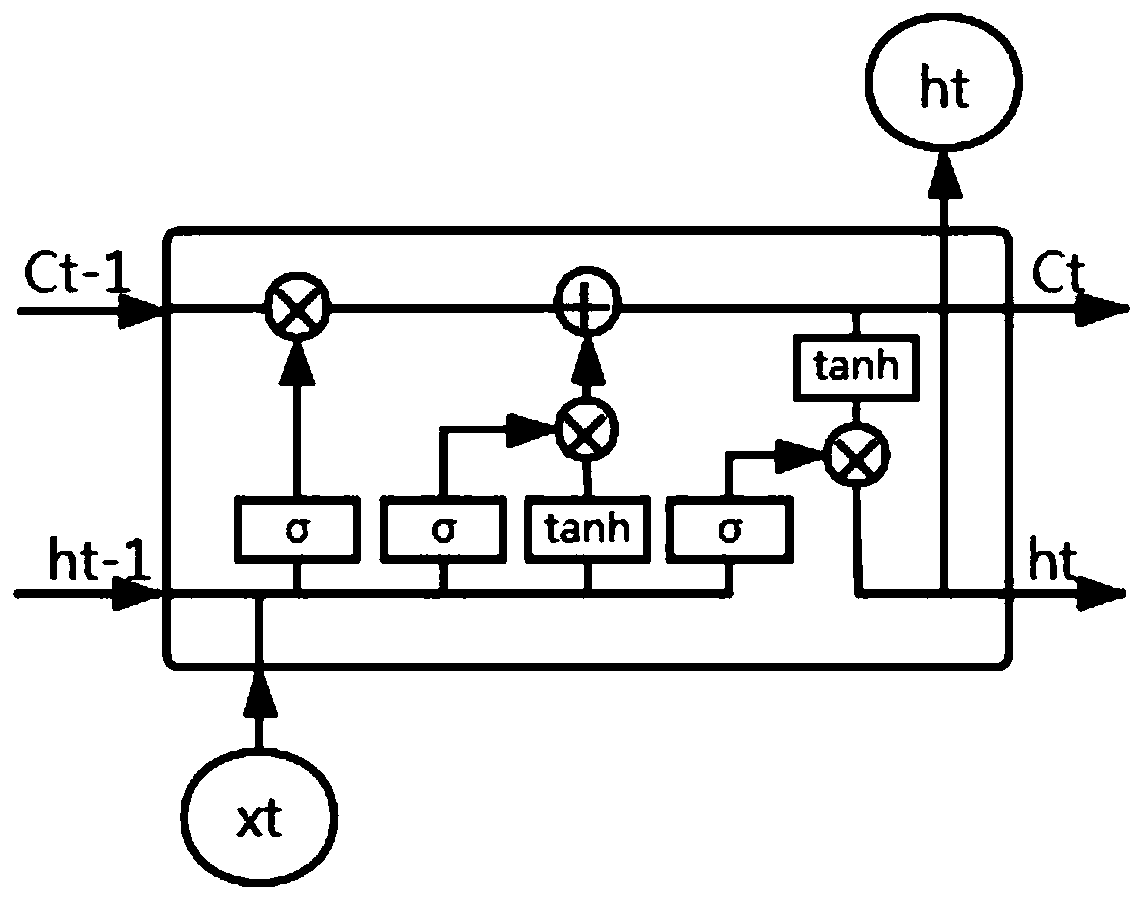

Stock price prediction method of long-term and short-term memory neural network based on attention mechanism

PendingCN111222992AEasy to predictNon-linear variation is goodFinanceNeural architecturesStock price forecastingEngineering

The invention discloses a stock price prediction method based on a long-term and short-term memory neural network of an attention mechanism, and belongs to the field of deep learning and stock prediction. The method comprises the following steps of S1, obtaining stock historical data, performing data preprocessing on the stock historical data, and dividing the stock historical data into a trainingset and a test set; s2, performing data standardization on the training set and the test set, and performing wavelet transform processing on data of the training set to remove noise of the financialsequence; s3, initializing parameters required by the long-term and short-term memory neural network prediction model, constructing the long-term and short-term memory neural network prediction model,adding an attention mechanism layer into the long-term and short-term memory neural network prediction model, and training the long-term and short-term memory neural network prediction model by usingtraining set data; and S4, predicting the test set by using the trained prediction model to obtain a prediction result. According to the invention, the nonlinear change of the stock price can be better predicted.

Owner:DALIAN UNIV

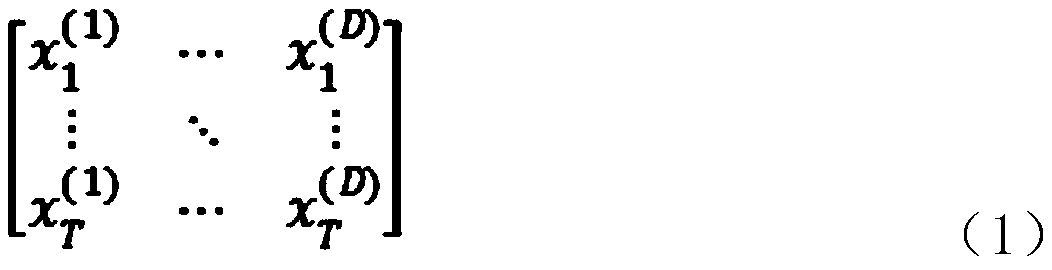

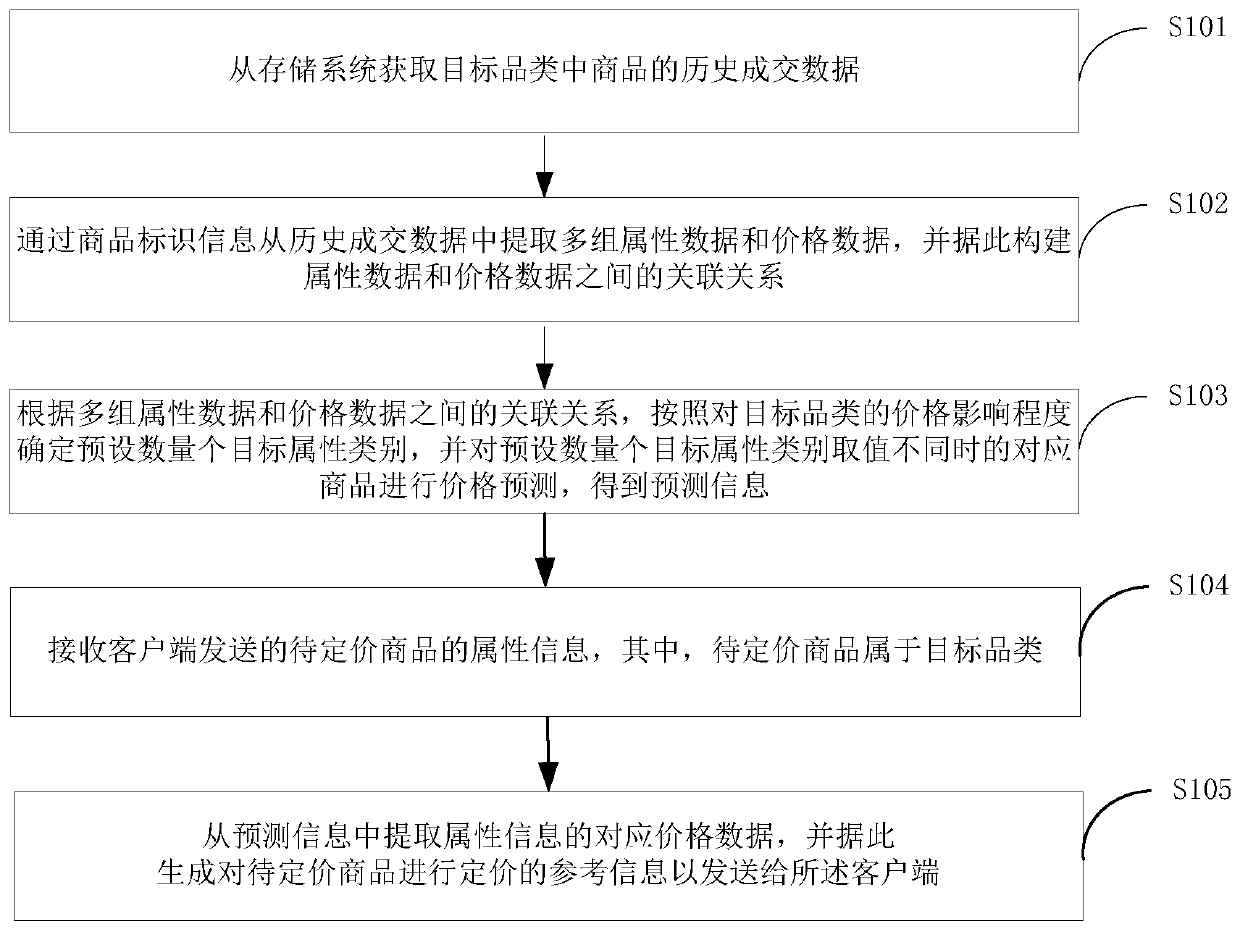

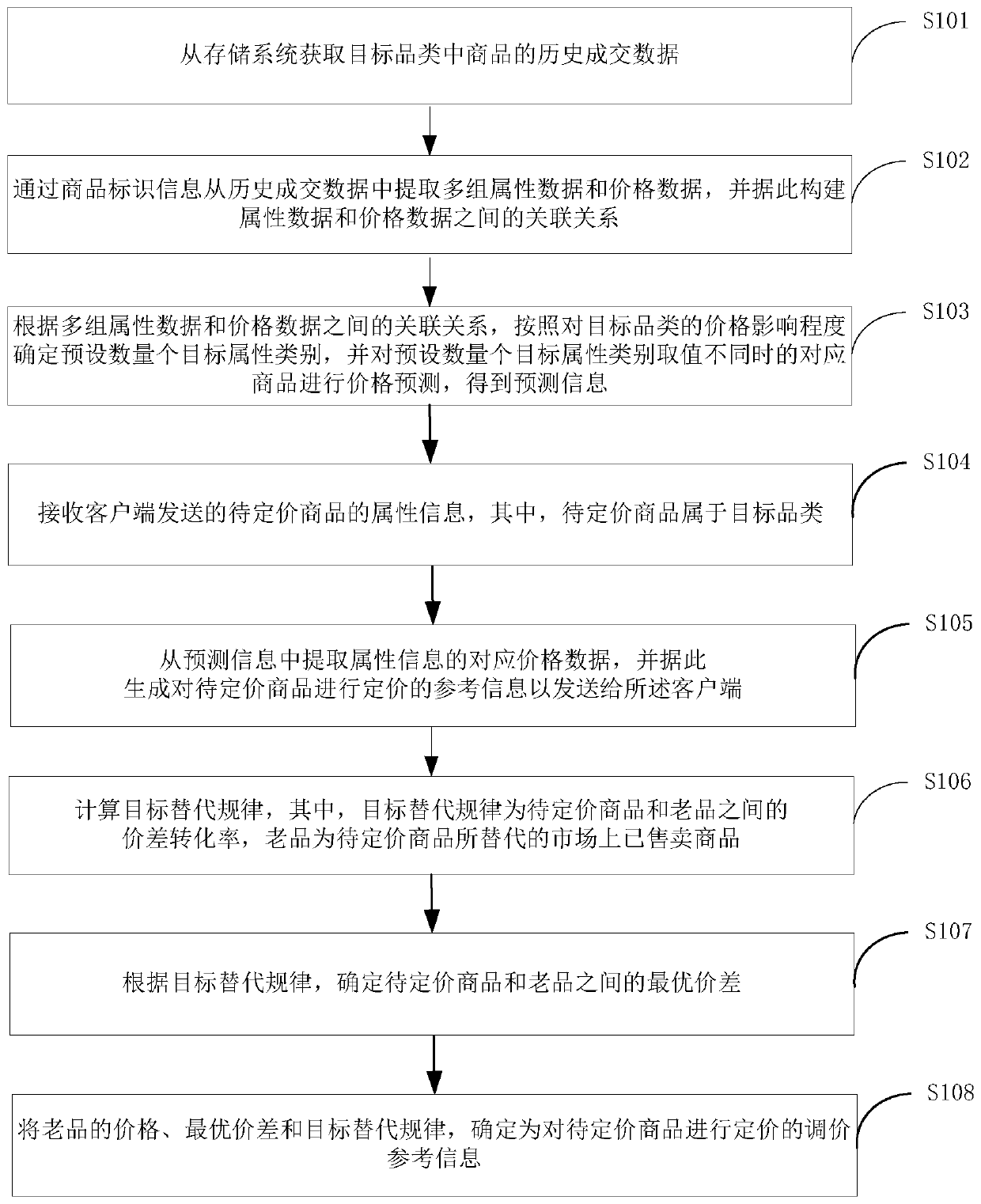

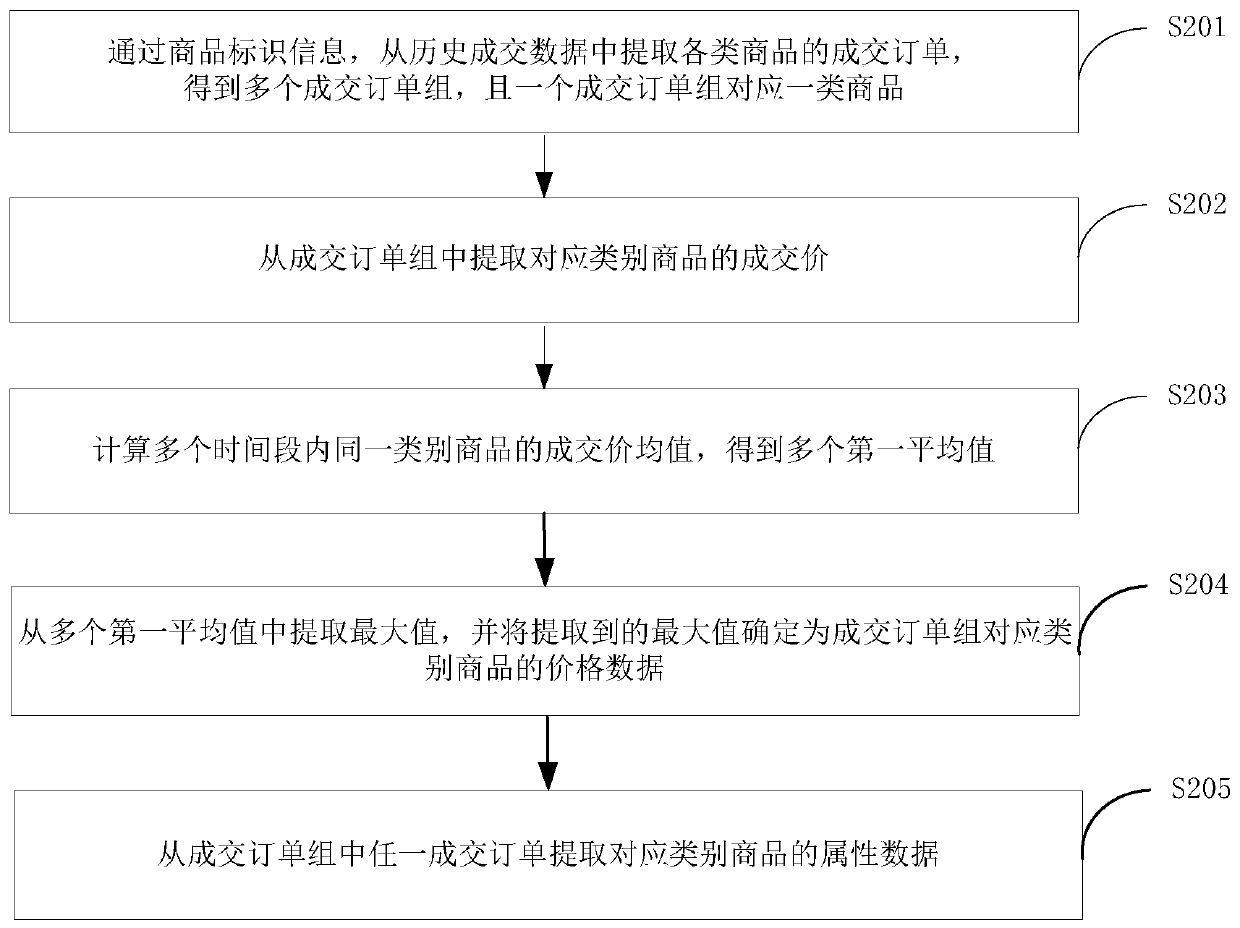

Reference information generation method, system and device

PendingCN111489180ATroubleshoot technical issues with unreasonable pricingScientific and Reasonable Pricing Reference InformationMarket predictionsTransaction dataPrice prediction

The embodiment of the invention provides a reference information generation method, system and device. The method comprises the steps of obtaining historical transaction data of commodities in a target category from a storage system; extracting multiple groups of attribute data and price data from the historical transaction data through the commodity identification information; according to the incidence relation between the multiple sets of attribute data and the price data, determining a preset number of target attribute categories having large influence degrees on the prices of the target categories according to the influence degrees on the prices of the target categories, and carrying out price prediction on the corresponding commodities when the values of the target attribute categories are different to obtain prediction information; receiving attribute information of a to-be-priced commodity sent by the client, the to-be-priced commodity belonging to a target category; and extracting corresponding price data of the attribute information from the prediction information, generating reference information for pricing the commodity to be priced according to the price data, and sending the reference information to the client. The pricing reference information provided by the invention solves the technical problem that a traditional commodity pricing method is unreasonable in pricing.

Owner:BEIJING JINGDONG SHANGKE INFORMATION TECH CO LTD +1

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com