Patents

Literature

42 results about "Stock prediction" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

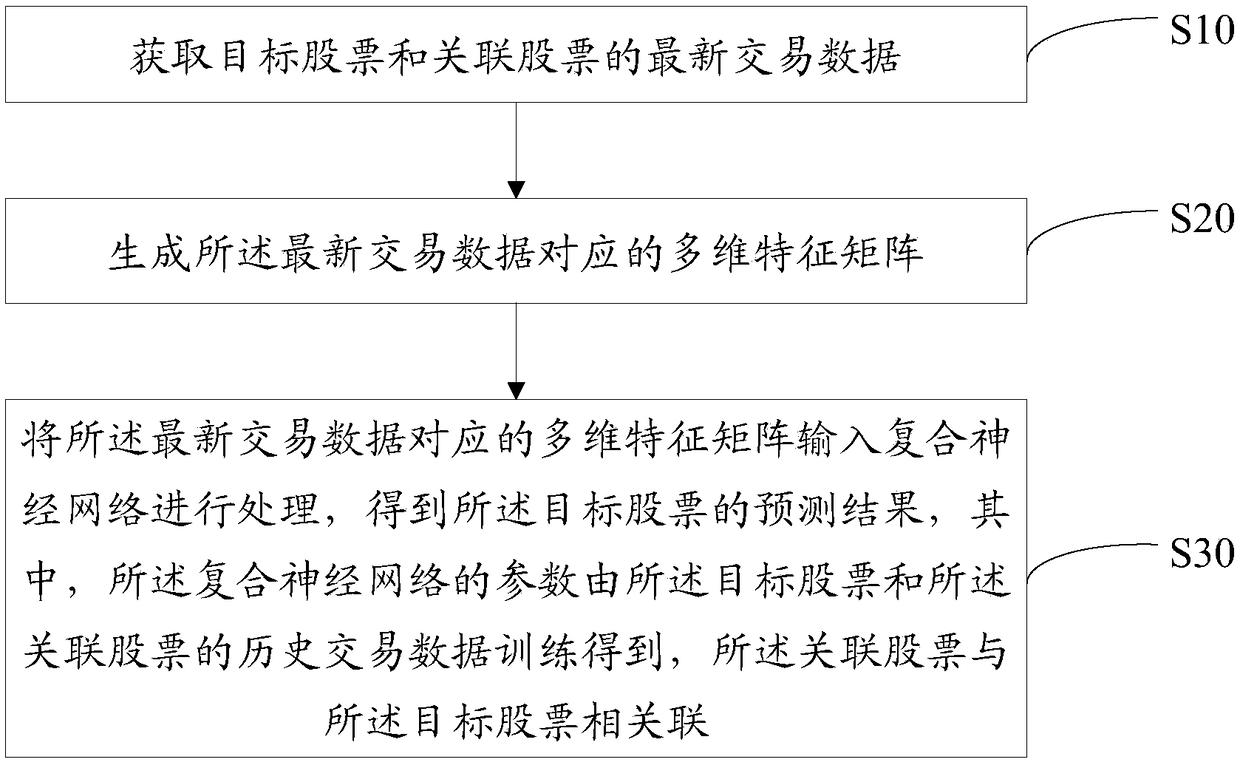

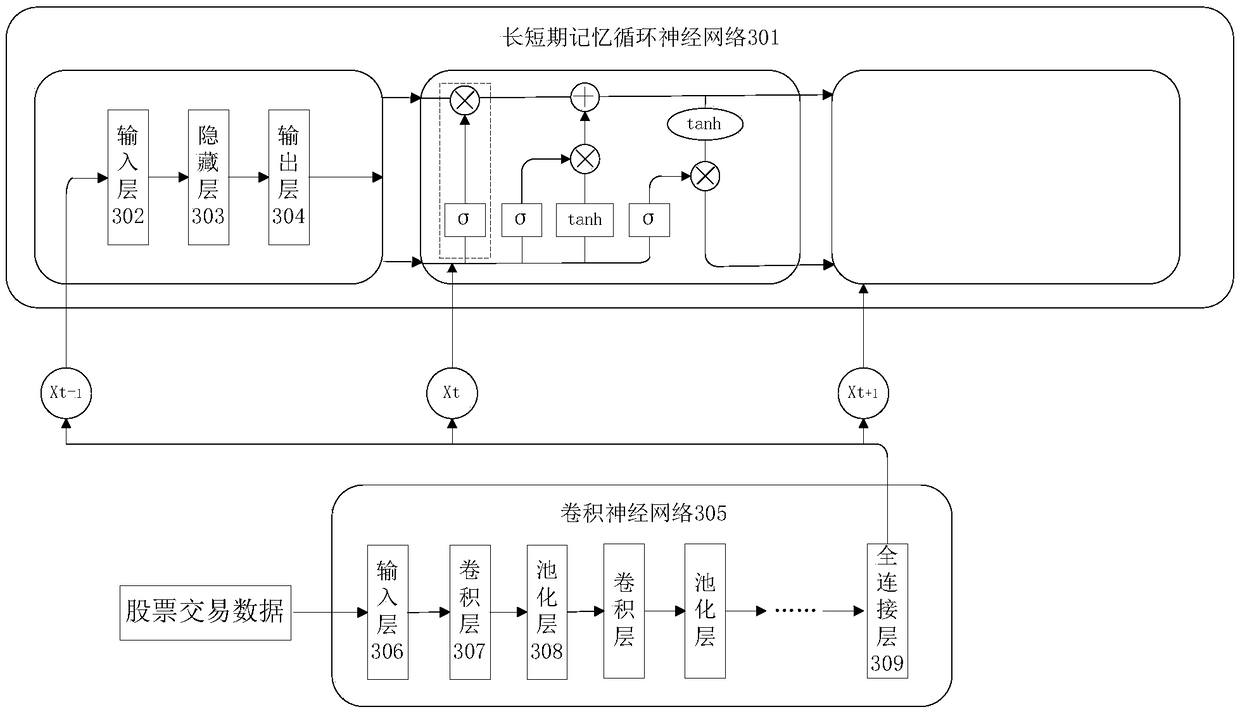

Stock prediction method, device and apparatus based on depth learning and storage medium

The invention discloses a stock prediction method based on depth learning, which includes: obtaining the latest transaction data for the target stock and associated stock, generating a multi-dimensional feature matrix corresponding to the latest transaction data, inputting a multi-dimensional characteristic matrix corresponding to the latest transaction data into a composite neural network for processing, obtaining a prediction result of the target stock. The invention also discloses a stock prediction device based on depth learning, stock prediction apparatus and storage medium based on in-depth learning; the invention firstly utilizes the convolution neural network of the composite neural network to learn the characteristics of the transaction data of the target stock and the associatedstock, Features are input into the composite neural network of short-term and long-term memory network for processing, and the prediction of the stock price rise and fall is obtained. A stock forecastmethod based on depth learning and swarm intelligence is provided, which can accurately forecast the stock price rise and fall.

Owner:SUN YAT SEN UNIV

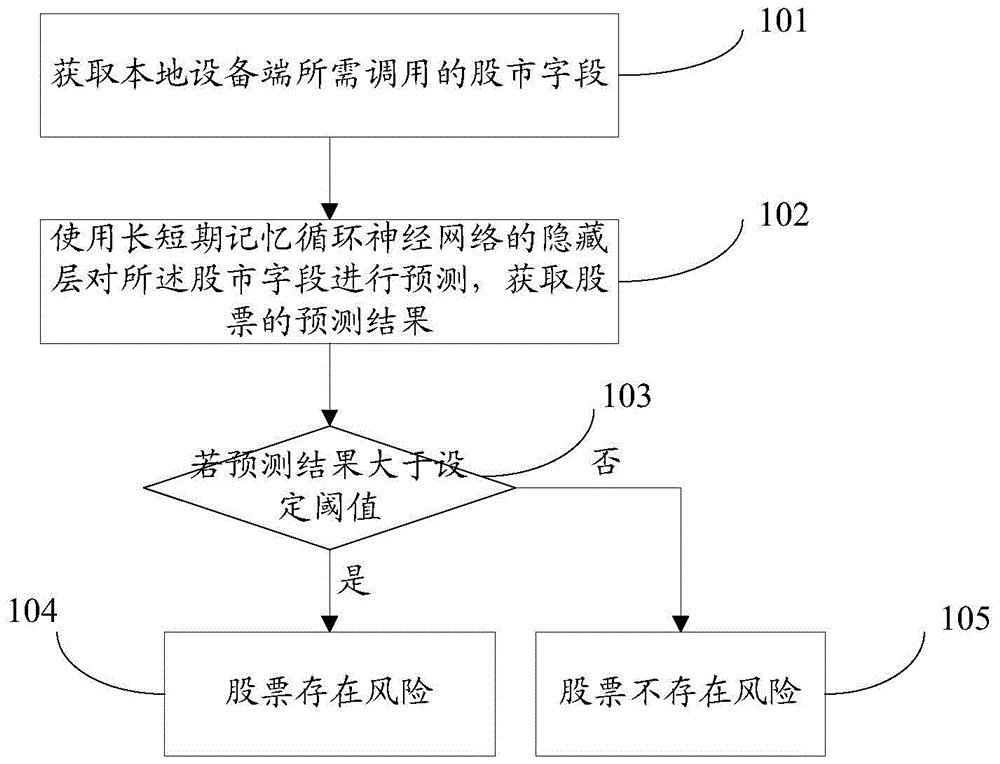

Stock risk prediction method and apparatus

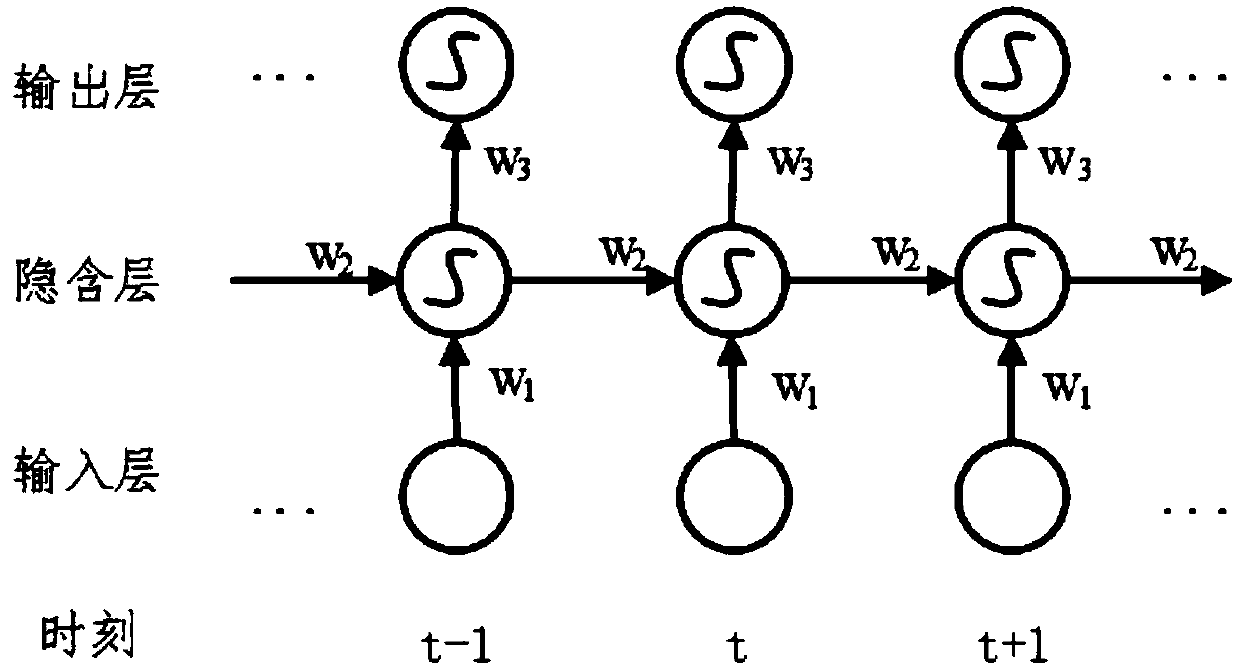

The application provides a stock risk prediction method and an apparatus. The method includes the following steps: acquiring stock fields required by a local device terminal to be invoked; based on a hidden layer in the long and short term memory circulation neural network, predicting the stock fields to obtain a prediction result of the stock. The prediction result includes a prediction value of a fluctuation ratio of a stock market on a trading day. The long and short term memory circulation neural network also includes an input layer and an output layer. If the prediction result is greater than a determined threshold value, there are risks in the stock. According to the invention, the method and apparatus address the problem of high risks caused by inaccurate stock prediction by using the ARCH model or the GARCH model.

Owner:TSINGHUA UNIV

Method for predicting stock trends by applying deep learning technology

Existing stock forecasting methods can only rely on expert knowledge and the screening and refining of market data and information. It is difficult to directly model from market data to operating laws, or they are mostly based on various market indicators. These indicators include: Specific calculation formulas can reflect some characteristics of the market, but they have transformed the most original transaction data, resulting in information loss to some extent. The present invention proposes a stock trend forecasting method using deep learning technology, using deep learning technology to establish a stock trend model, using historical daily transaction data as training data to train the model, and using transaction data for a period of time before the current trading day to predict a period of time after the current trading day trend is predicted. The purpose of the present invention is to discover potential profit opportunities in the current market from the historical transaction data of the market through a deep learning method, and guide the investment behavior of institutional investors and individual investors.

Owner:GUANGDONG UNIV OF TECH

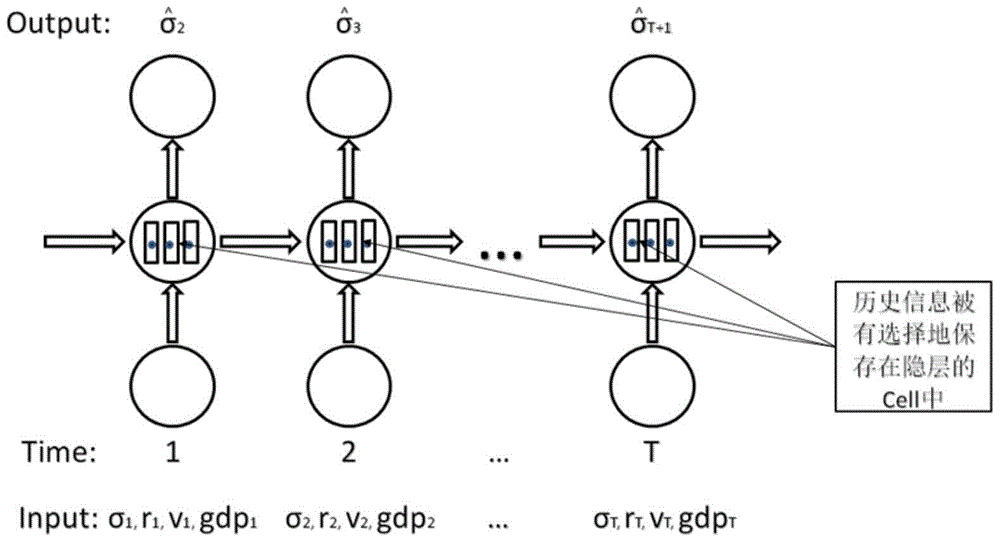

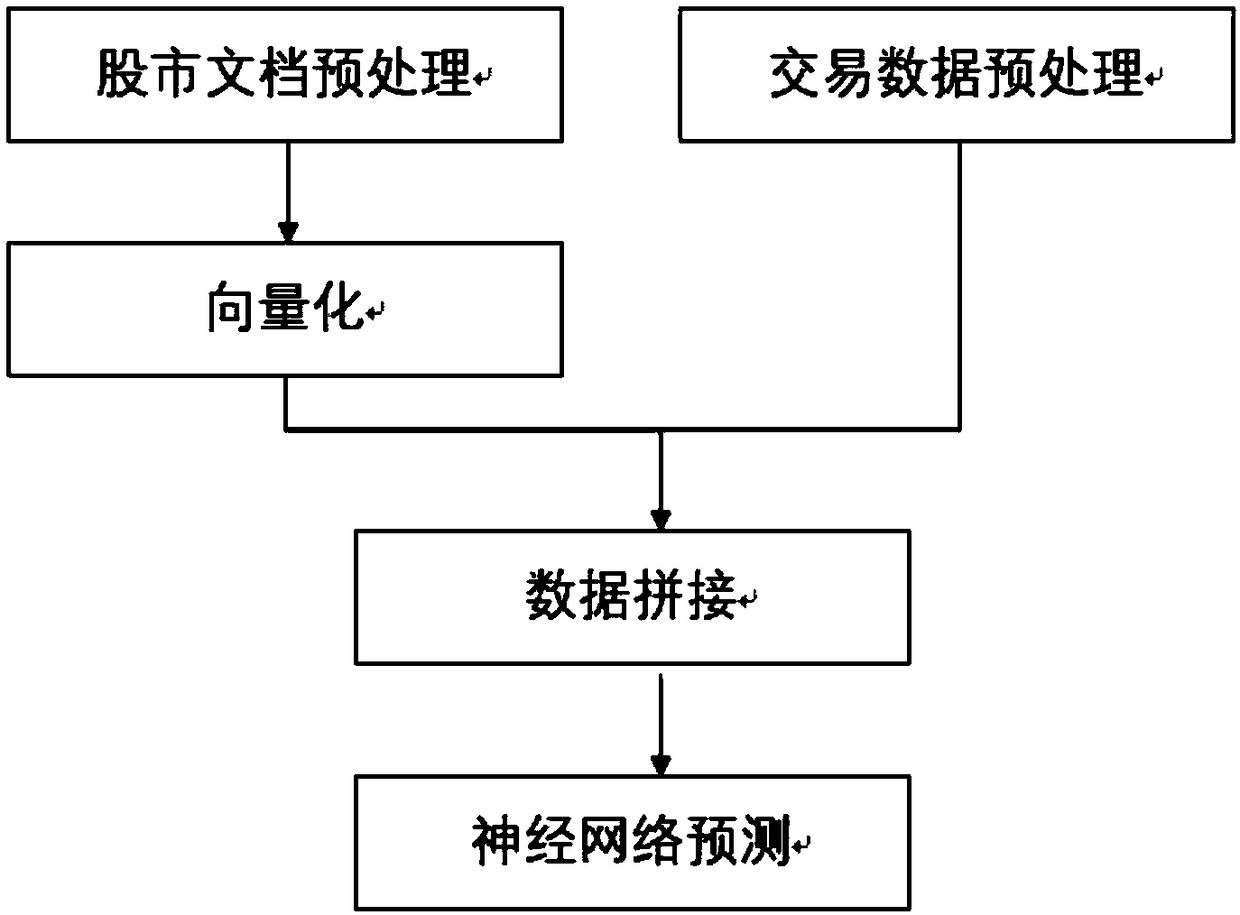

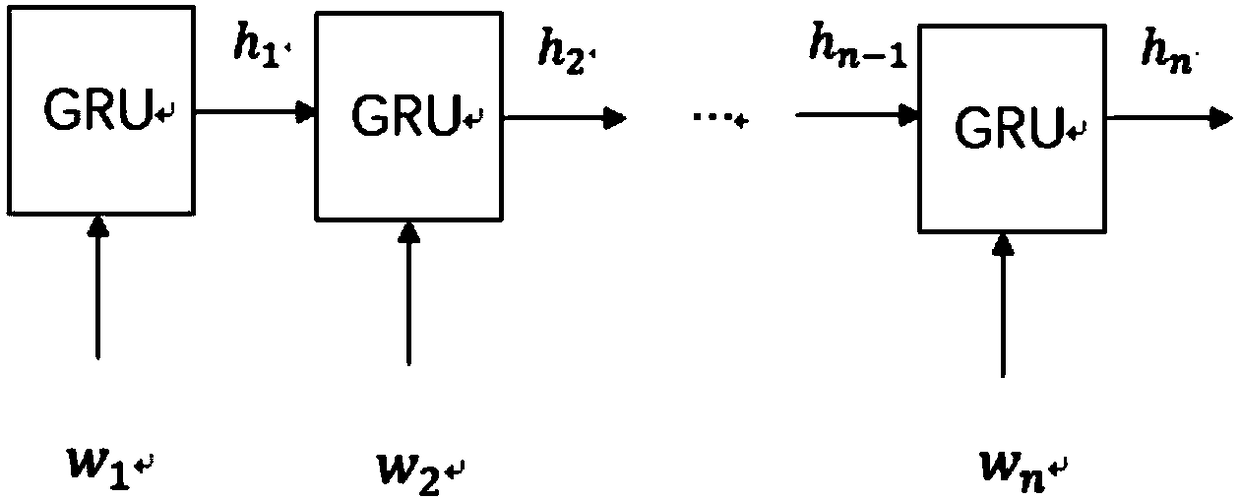

Stock prediction method which combines news corpus and stock market transaction data

InactiveCN108647828AImprove accuracyFully automatedFinanceForecastingInformation analysisAnalysis data

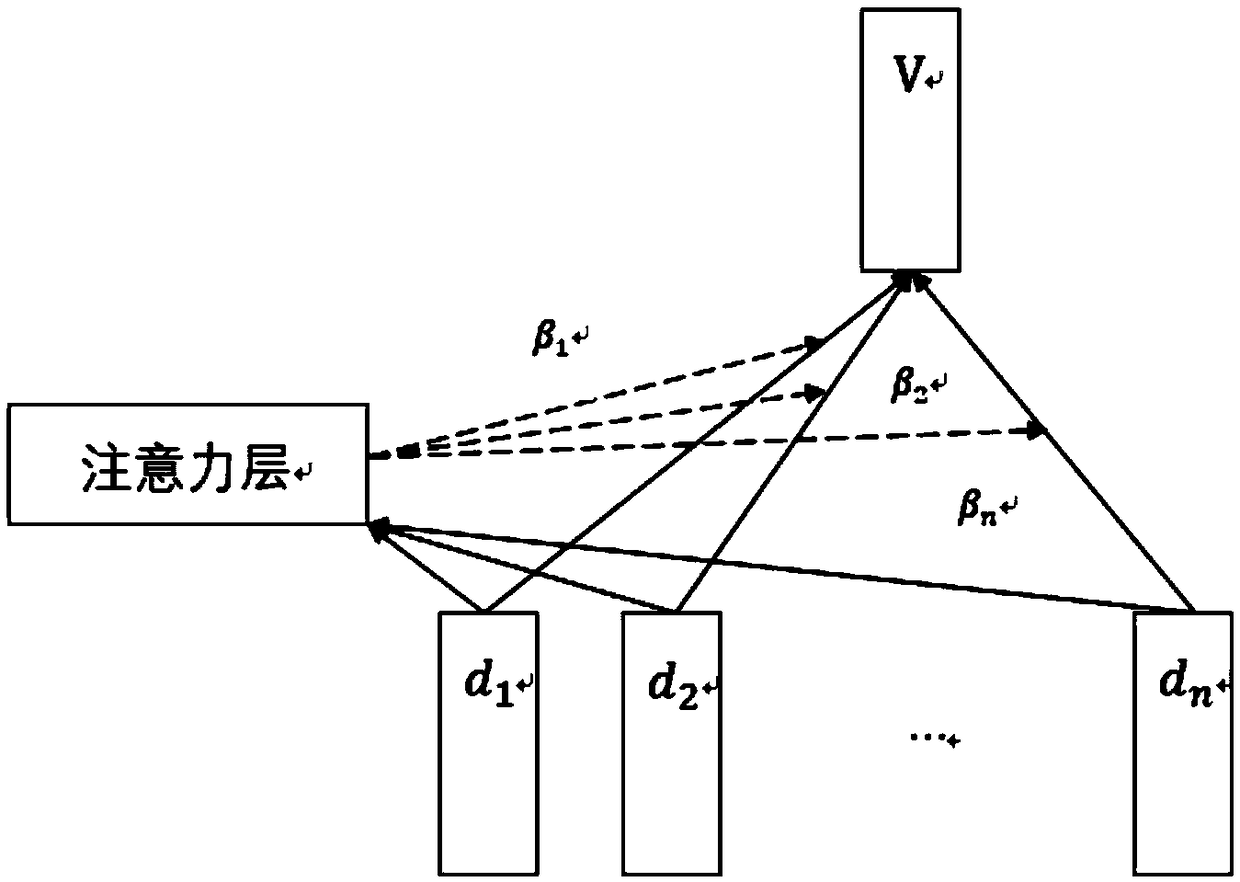

The invention provides a stock prediction method which combines news corpus and stock market transaction data. The method makes full use of a large amount of corpus information of a network and breaksthe traditional boundary of a single analysis data source. Through a deep learning model, the stock market news corpus can be analyzed in batches, and the importance of corpus for prediction can be judged automatically, thus the automation and precision of network information analysis are realized. Modeling is performed on news corpus and transaction data through deep learning, and the relationship between different data is comprehensively analyzed according to different information from many aspects. The influence of stock market information on the stock price, the persistence of the stock market information and the investor's psychological factor are grasped, so that the stock market forecast accuracy is further improved; and the word vector, a GRU neural network, an attention mechanismand other in-depth learning cutting-edge technology are used, so that the implementation of science into the industry is realized, and scientific and technological innovation is achieved.

Owner:SUN YAT SEN UNIV +1

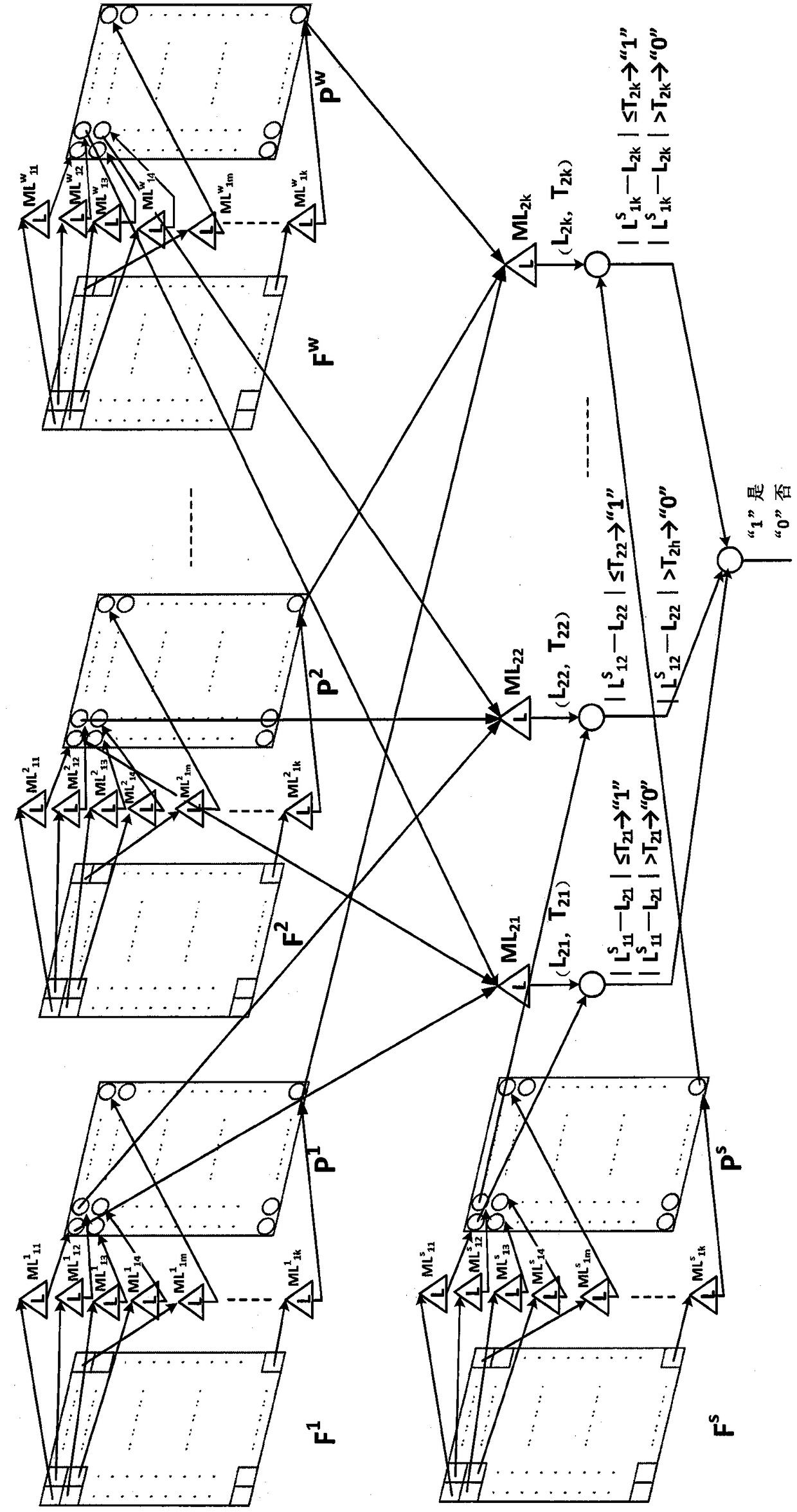

Adaptive stock prediction method of hidden Markov model based on multi-characteristic factor

InactiveCN108241872AGood forecastAccurate settingFinanceCharacter and pattern recognitionFeature vectorMomentum

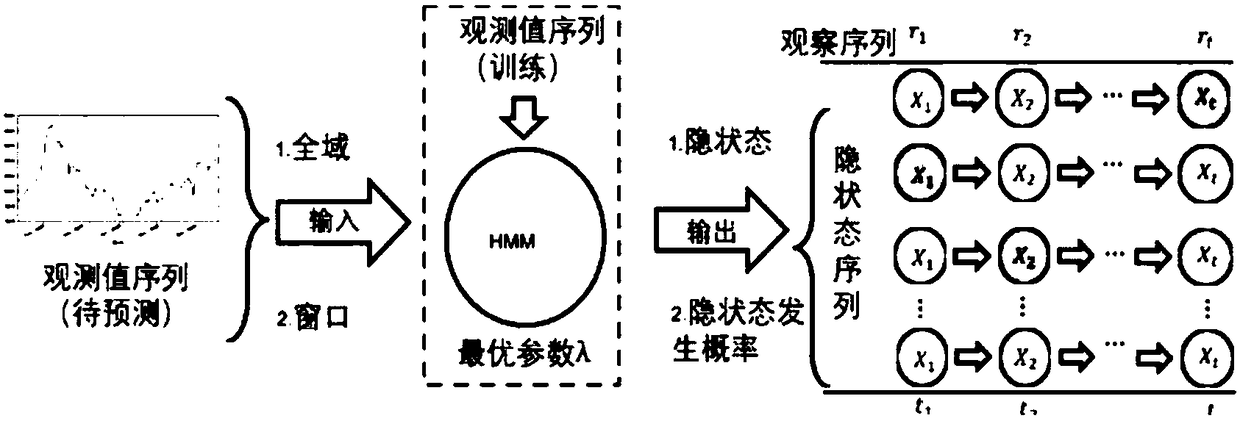

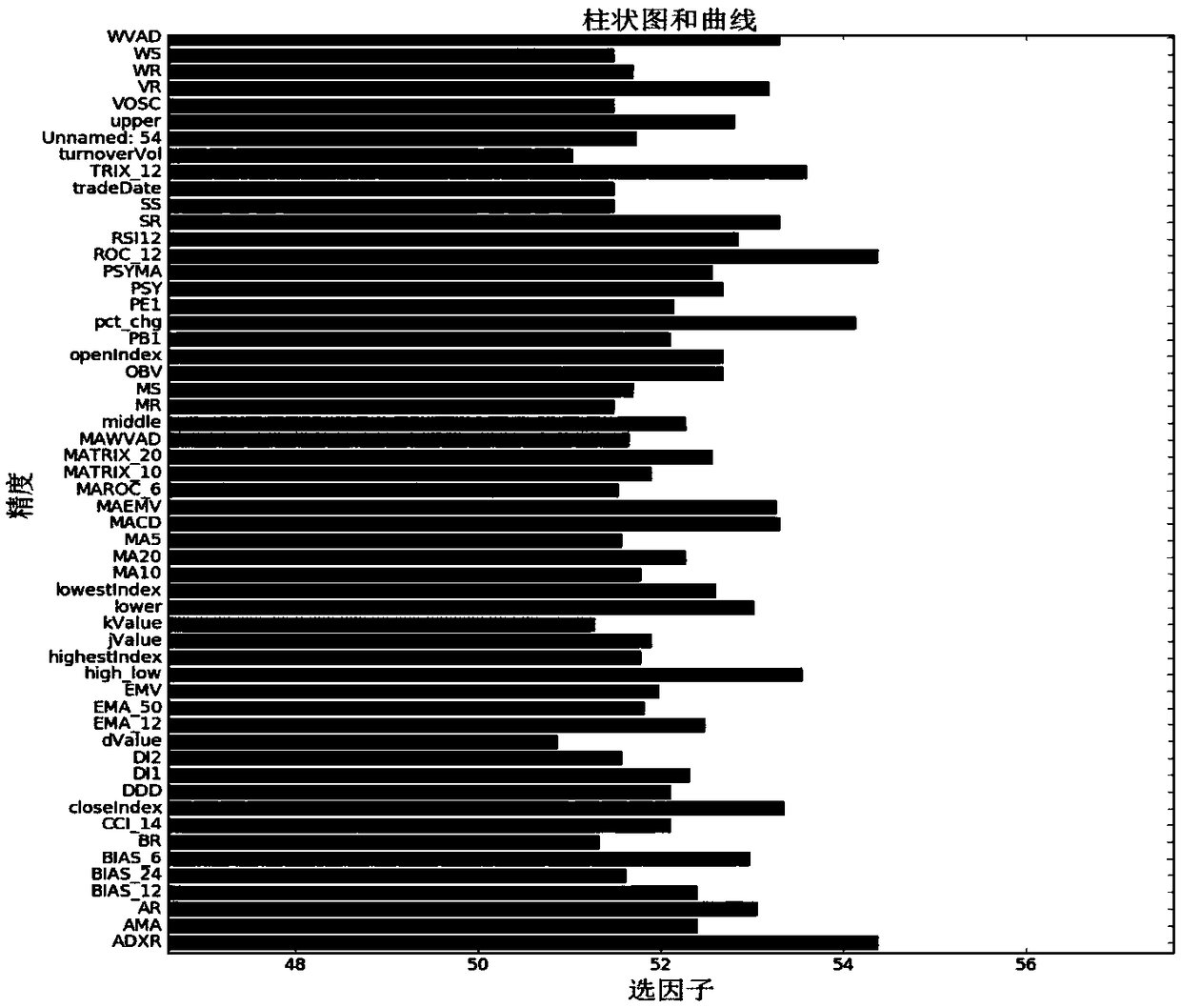

The invention discloses an adaptive stock prediction method of a HMM (hidden Markov model) based on multi-characteristic factors; the method mainly comprises stock sample data and the HMM; the stock prediction concept based on HMM comprises the following steps: marking time points of history data in a hidden state so as to classify time points; searching history points with consistent classification marks of the day before a to-be-predicted date; calculating to obtain the increase and decrease amounts of the history points and the date after the history points, and estimating the closing priceresidual errors of the to-be-predicted date and the previous day. The method uses multi-characteristic attributes, and uses stock market value capital, technology and momentum indexes as primary election characteristics; the attributes with a stronger prediction capability are selected by various methods so as to serve as characteristic vectors; compared with a method using less characteristics,the adaptive stock prediction method is better in prediction capability.

Owner:BEIJING UNIV OF TECH

Stock price prediction method and system based on artificial intelligence

InactiveCN108022016AAccurate predictionMarket predictionsFinanceStock price forecastingFeature vector

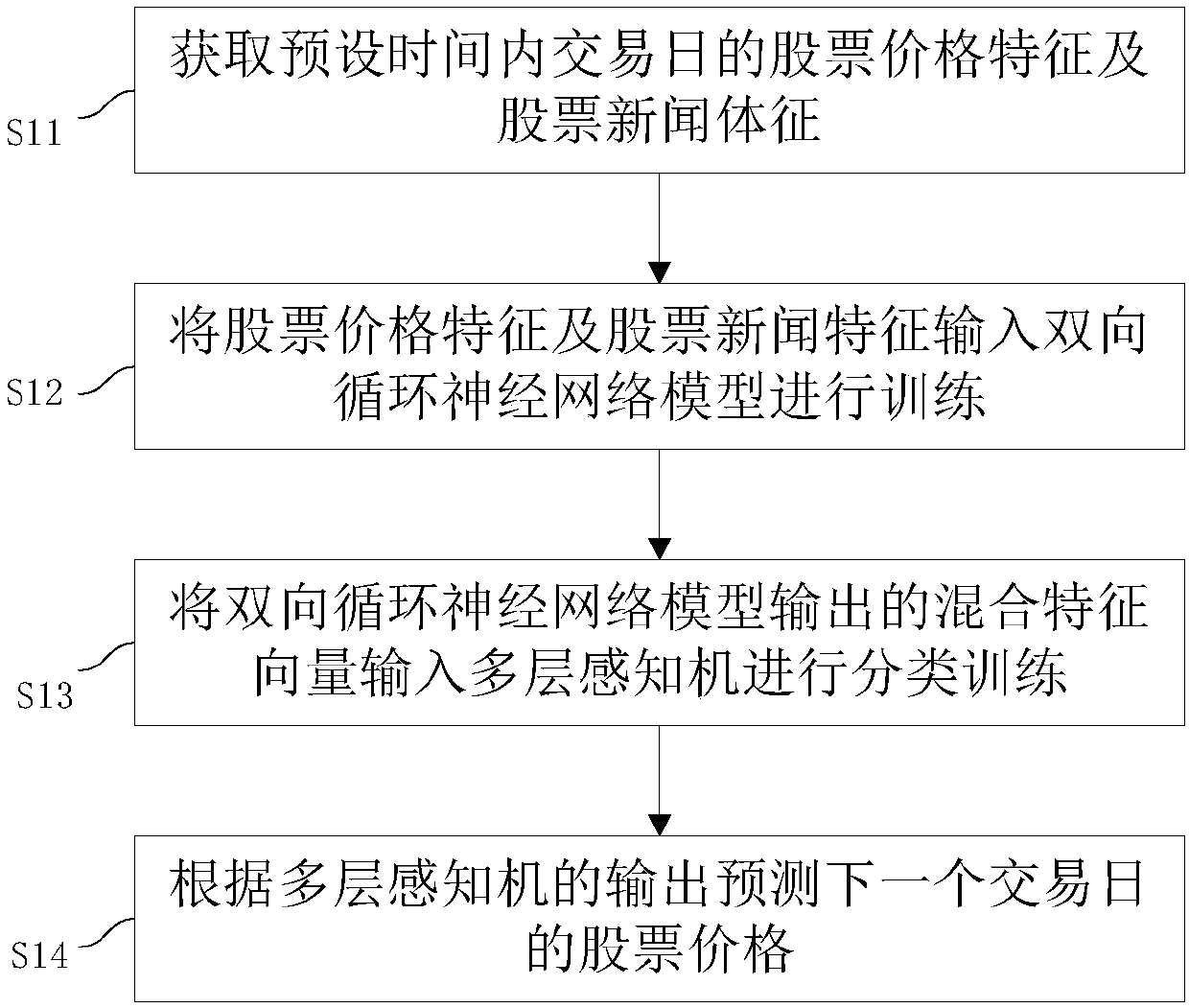

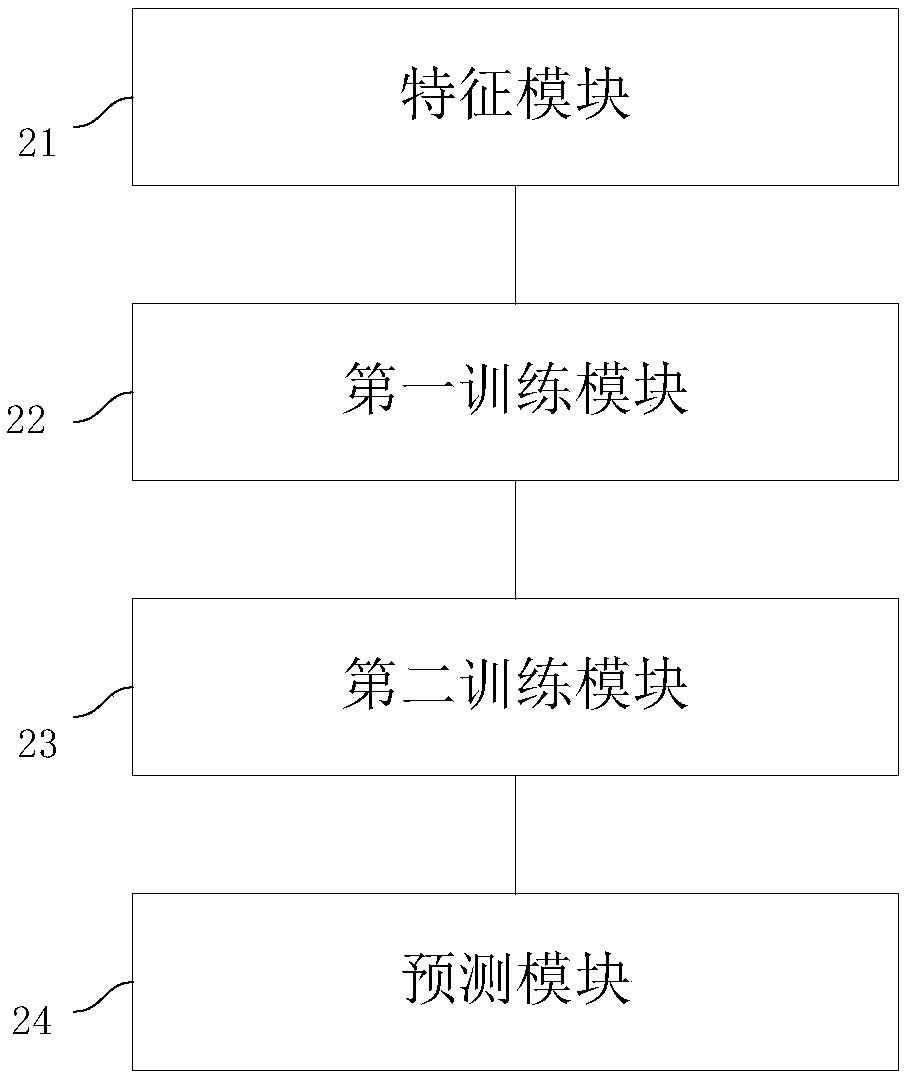

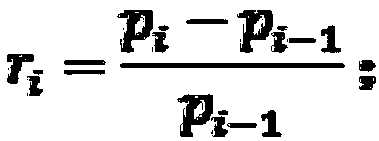

The invention discloses a stock price prediction method and system based on artificial intelligence, so as to solve the problem that considerations of the existing stock prediction are one-sided. Themethod includes the steps of acquiring stock price features and stock news features on a trading day within a preset time; inputting the stock price features and the stock news features into a bidirectional recurrent neural network model for training; inputting a mixed feature vector output by the bidirectional recurrent neural network model to a multi-layer perceptron for classification training;and predicting the stock price on a next trading day based on the output of the multi-layer perceptron. According to the invention, on the basis of a framework of a bidirectional recurrent network, the price features and the news features are combined and the acquired data information is fully utilized to more accurately predict the stock price.

Owner:宏谷信息科技(珠海)有限公司 +1

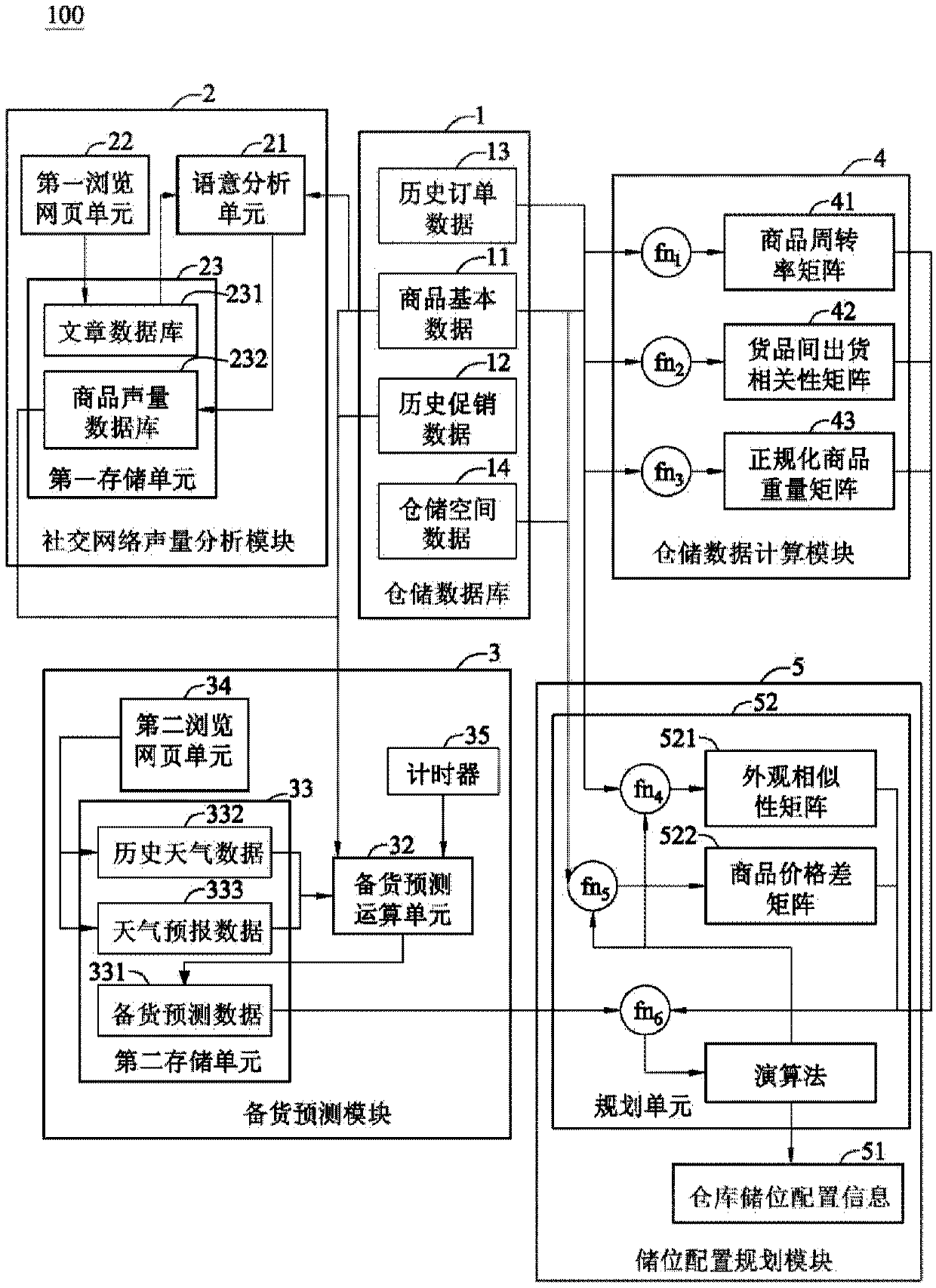

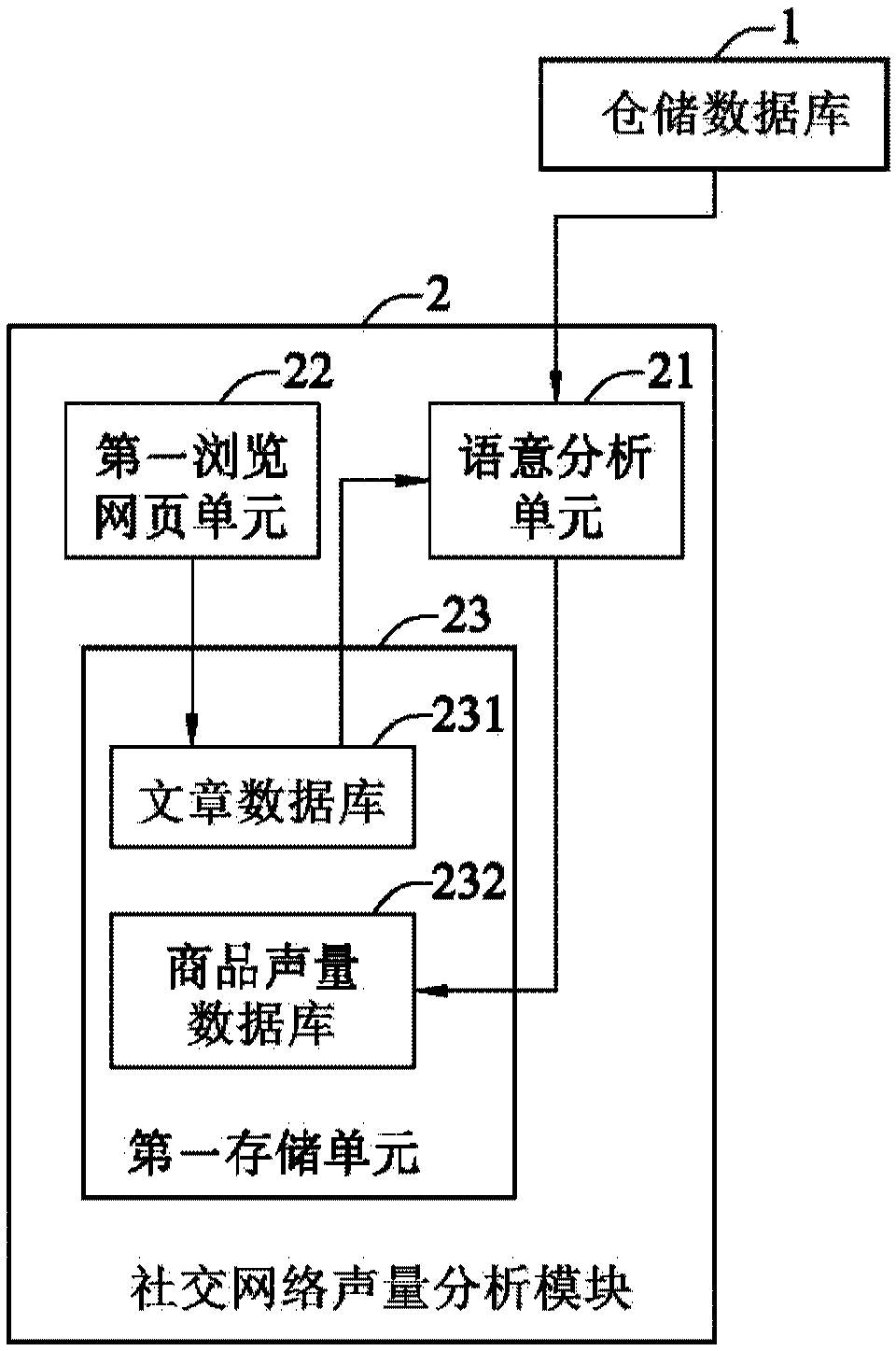

Warehousing storage location configuration system

ActiveCN110874670AEfficiently manage configurationDecrease stockForecastingLogisticsVolume analysisData mining

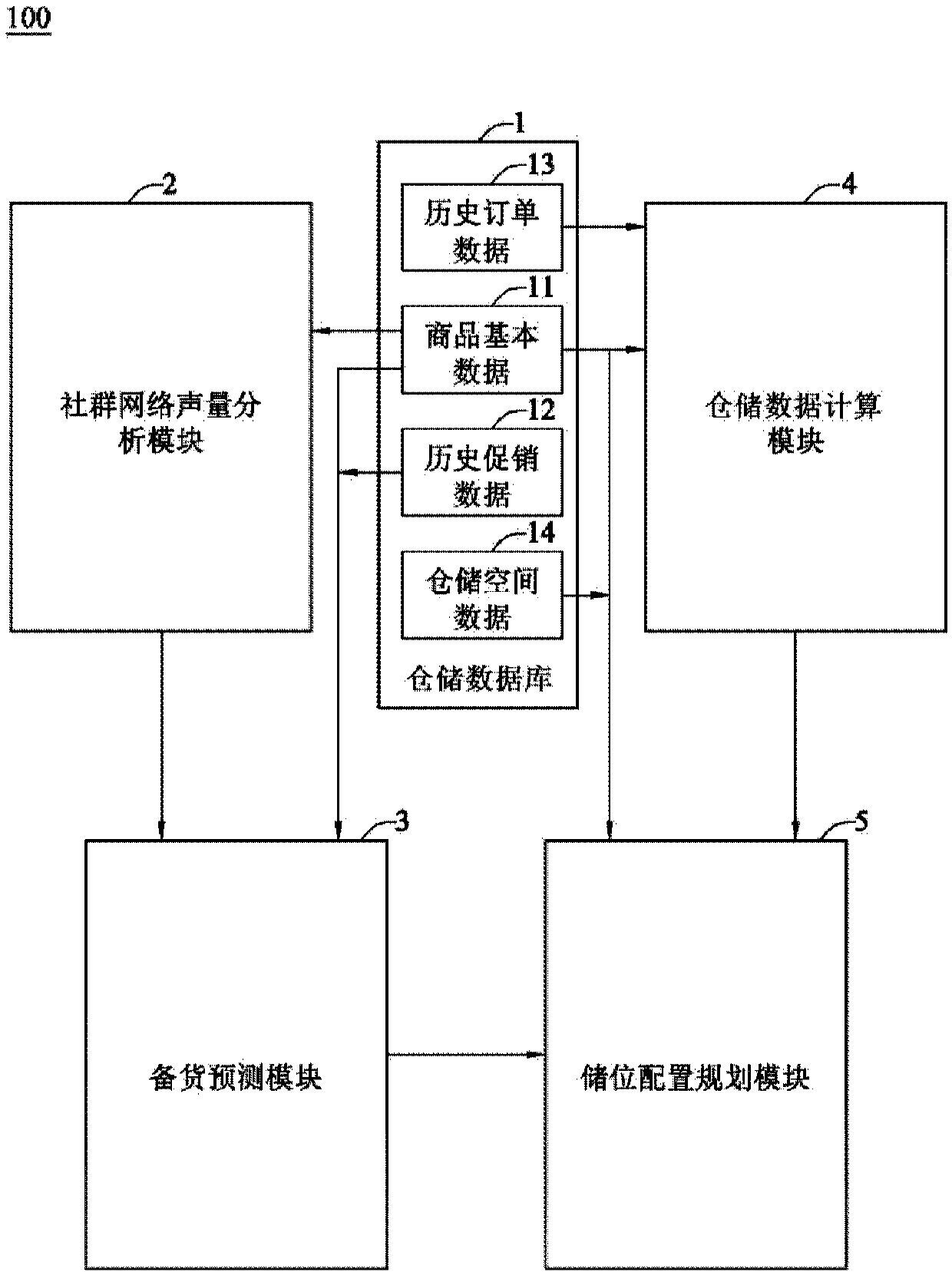

The invention discloses a warehousing storage location configuration system. The system comprises a warehousing database, a social network sound volume analysis module, a stock prediction module, a warehousing data calculation module and a warehousing location configuration planning module. The social network sound volume analysis module provides commodity sound volume data related to an externalsocial network; the stock prediction module provides stock prediction data; and the warehousing data calculation module provides a commodity data matrix related to the state of the goods in the warehouse, so that the warehousing location configuration planning module comprehensively considers the data provided by the warehousing database, the stock prediction module and the warehousing data calculation module to generate warehousing warehousing location configuration information, and the purpose of optimizing the warehousing location configuration is achieved.

Owner:IND TECH RES INST

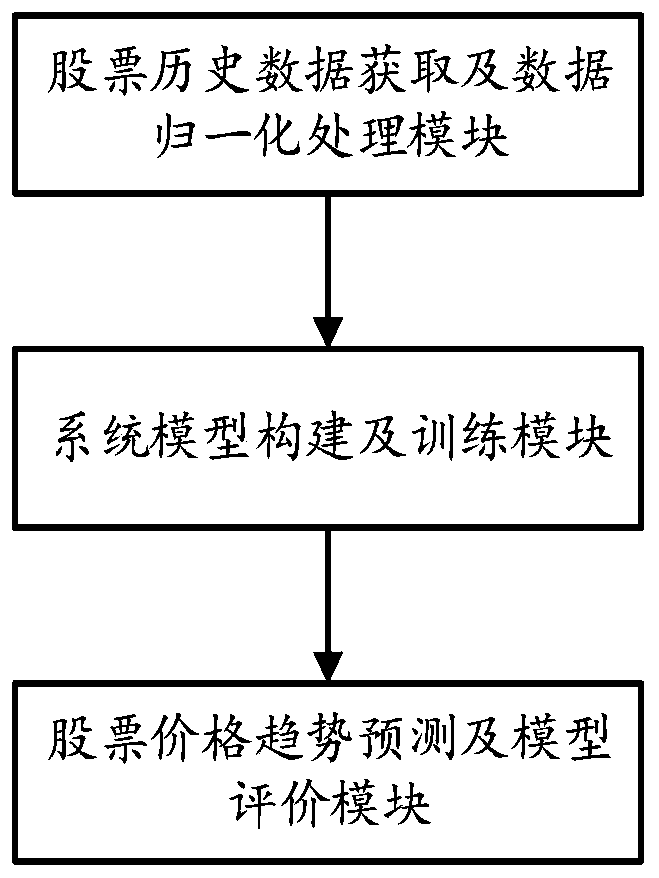

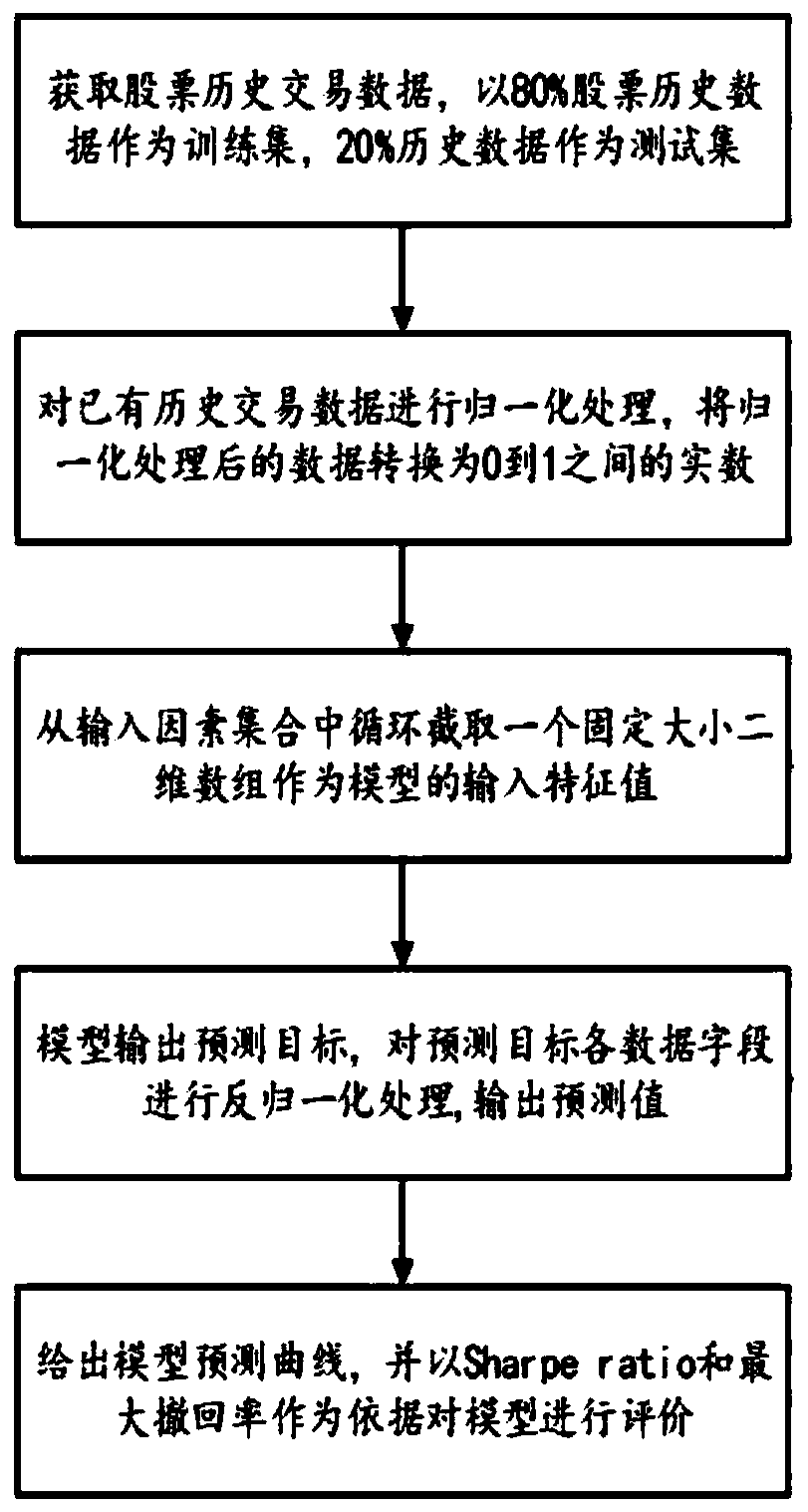

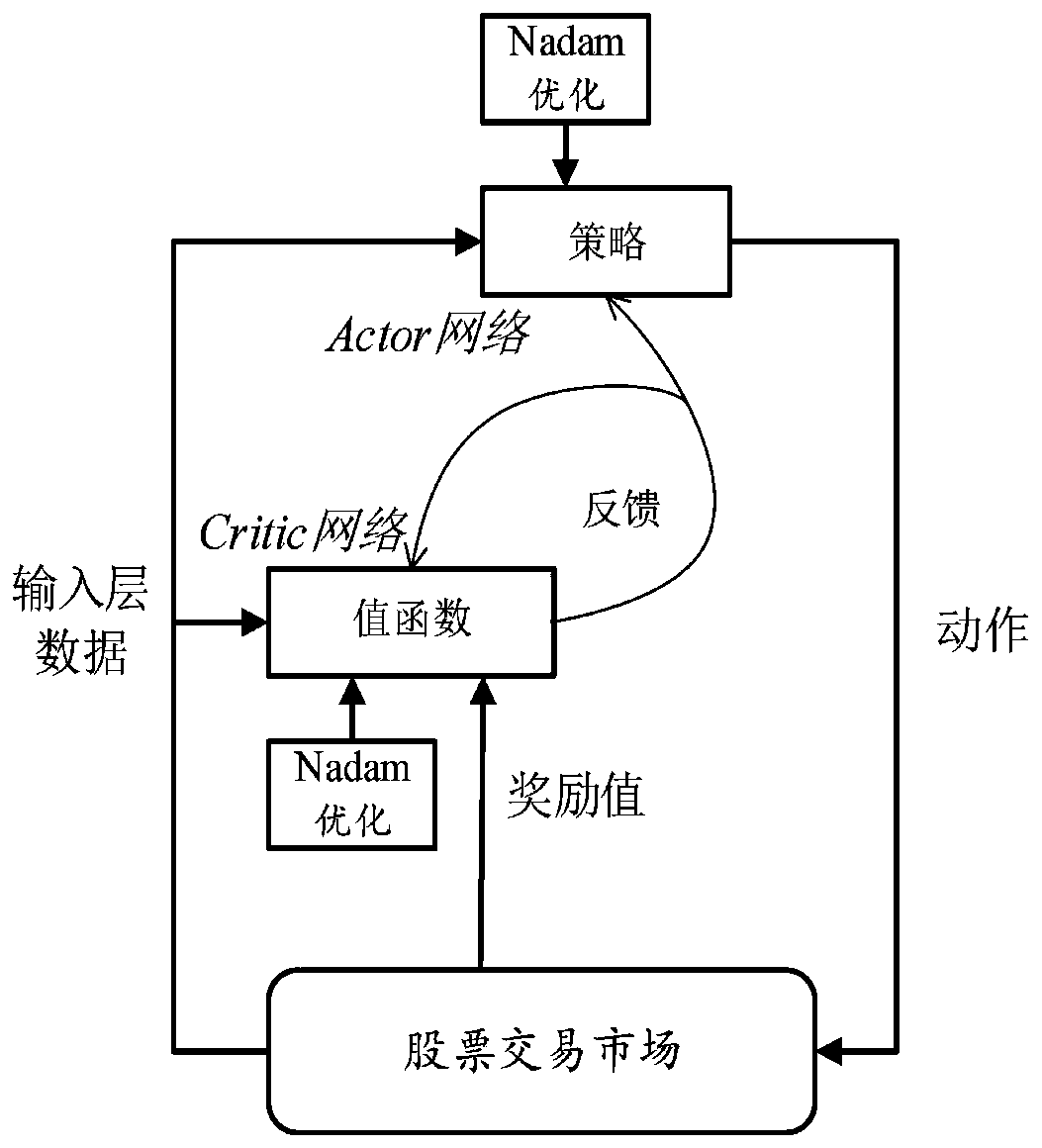

Stock prediction method and system based on reinforcement learning

InactiveCN110059896AReduce riskReduce the impact of noiseFinanceForecastingHidden layerReinforcement learning

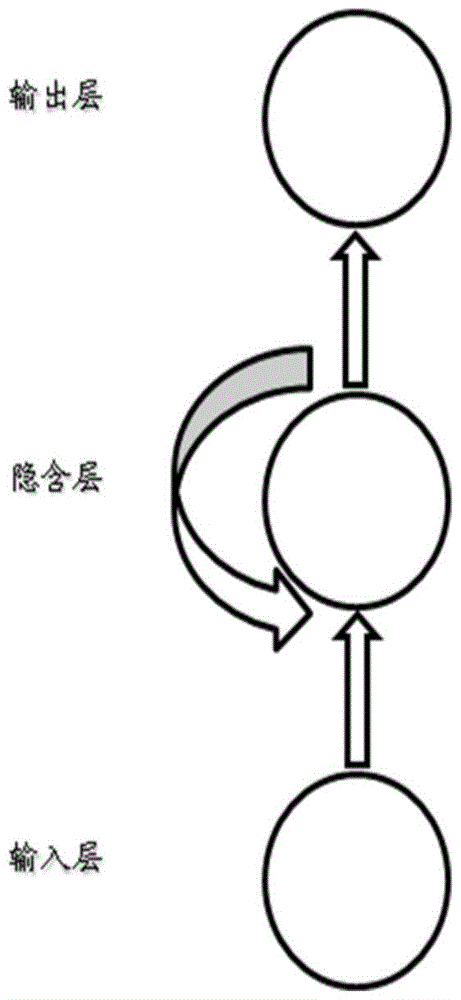

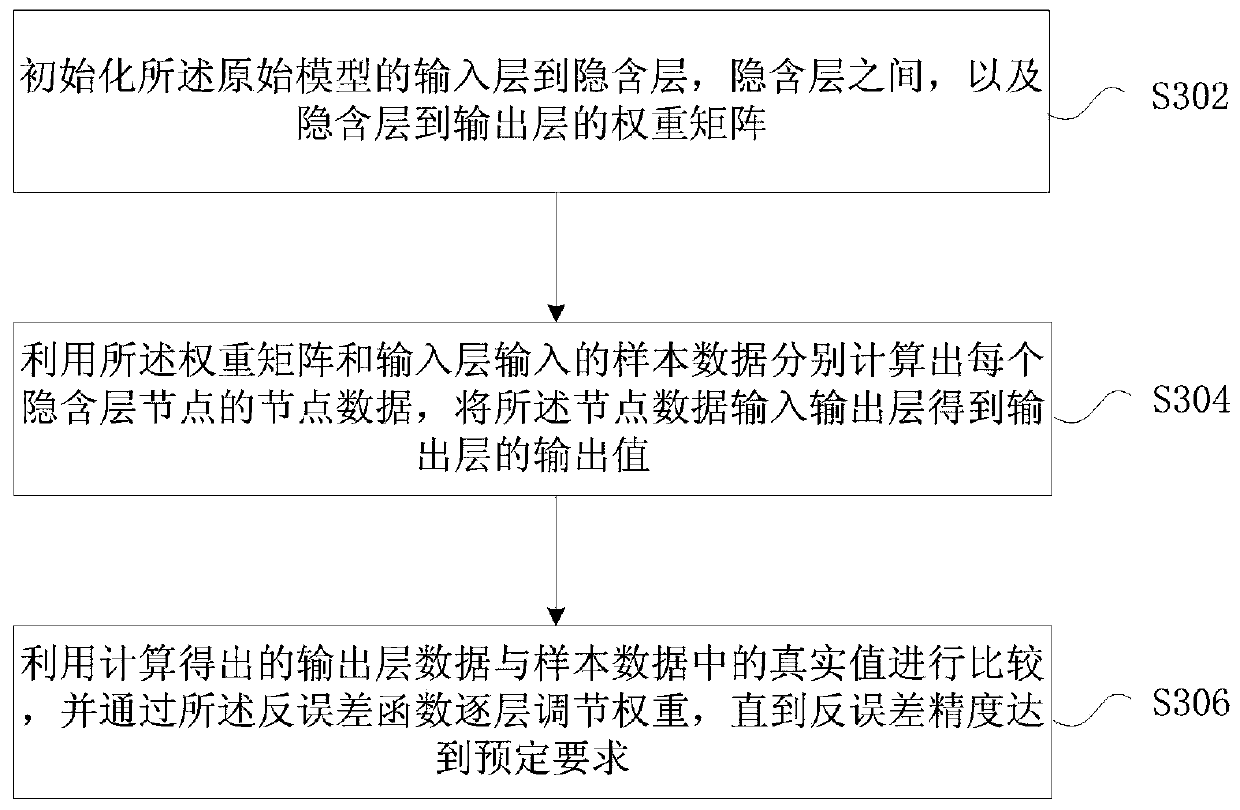

The invention discloses a stock prediction method and system based on reinforcement learning, and the method comprises the following steps: a, obtaining the historical data of a target stock, carryingout the normalization processing of the historical data, enabling all kinds of numerical values in the historical data to be zoomed to the same scale, and forming a training set; b, constructing a stock prediction model based on the reinforcement learning theory, wherein the stock prediction model comprises an input layer, a hidden layer and an output layer; inputting the training set into a stock prediction model for training; c, performing stock prediction by using the trained stock prediction model, and evaluating the stock prediction model on the basis of the summer general ratio and themaximum withdrawal rate. The method can achieve the purpose of predicting the stock price trend direction, helps a stock market investor to reduce the risk degree of stock investment, and obtains expected benefits.

Owner:ZHEJIANG UNIVERSITY OF SCIENCE AND TECHNOLOGY

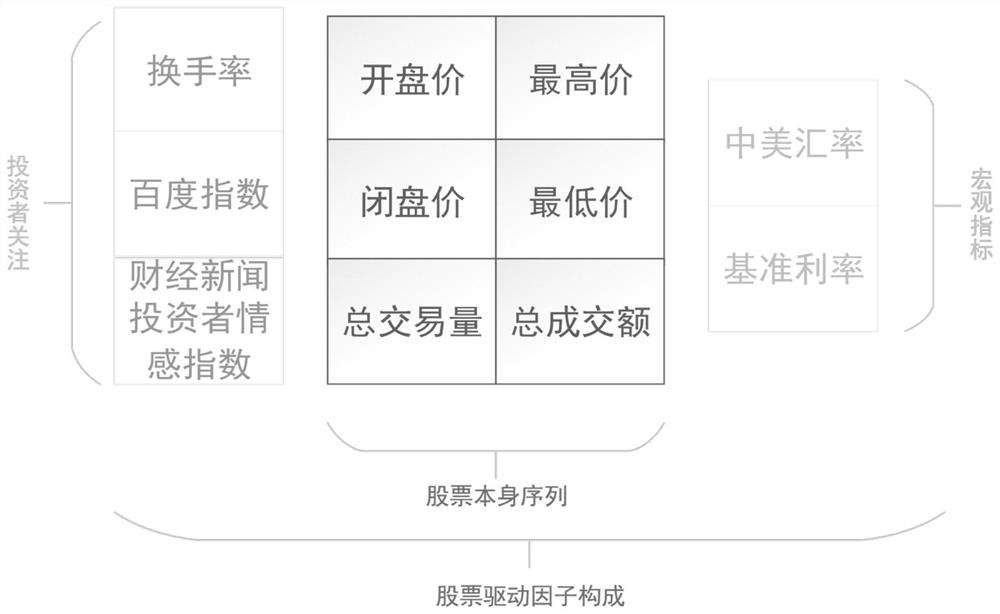

Stock prediction method fusing generative adversarial network and two-dimensional attention mechanism

InactiveCN113129148AHigh dependence on foreign tradePredicted target size is largeFinanceForecastingStock price forecastingGenerative adversarial network

The invention discloses a stock prediction method fusing a generative adversarial network and a two-dimensional attention mechanism. The method comprises the following steps: acquiring historical sequence data of a driving factor as stock sequence input; preprocessing the historical sequence data; divdiing the preprocessed historical sequence data into a training set and a test set, performing standardization, and generating two-dimensional data sequence input; weighting spatial attention of the two-dimensional data sequence input; weighting time attention pf the two-dimensional data sequence input after the space attention weighting; constructing a stock prediction preliminary model based on a two-dimensional time-space attention mechanism as a generator; modifying an output part structure of the generator to obtain a new generator; establishing a stock prediction model based on a newborn generator and a generative adversarial network discriminator; and constructing an optimization target of the stock prediction model to obtain an optimal stock prediction model. According to the invention, a more accurate and ideal stock price prediction result can be generated.

Owner:BEIHANG UNIV

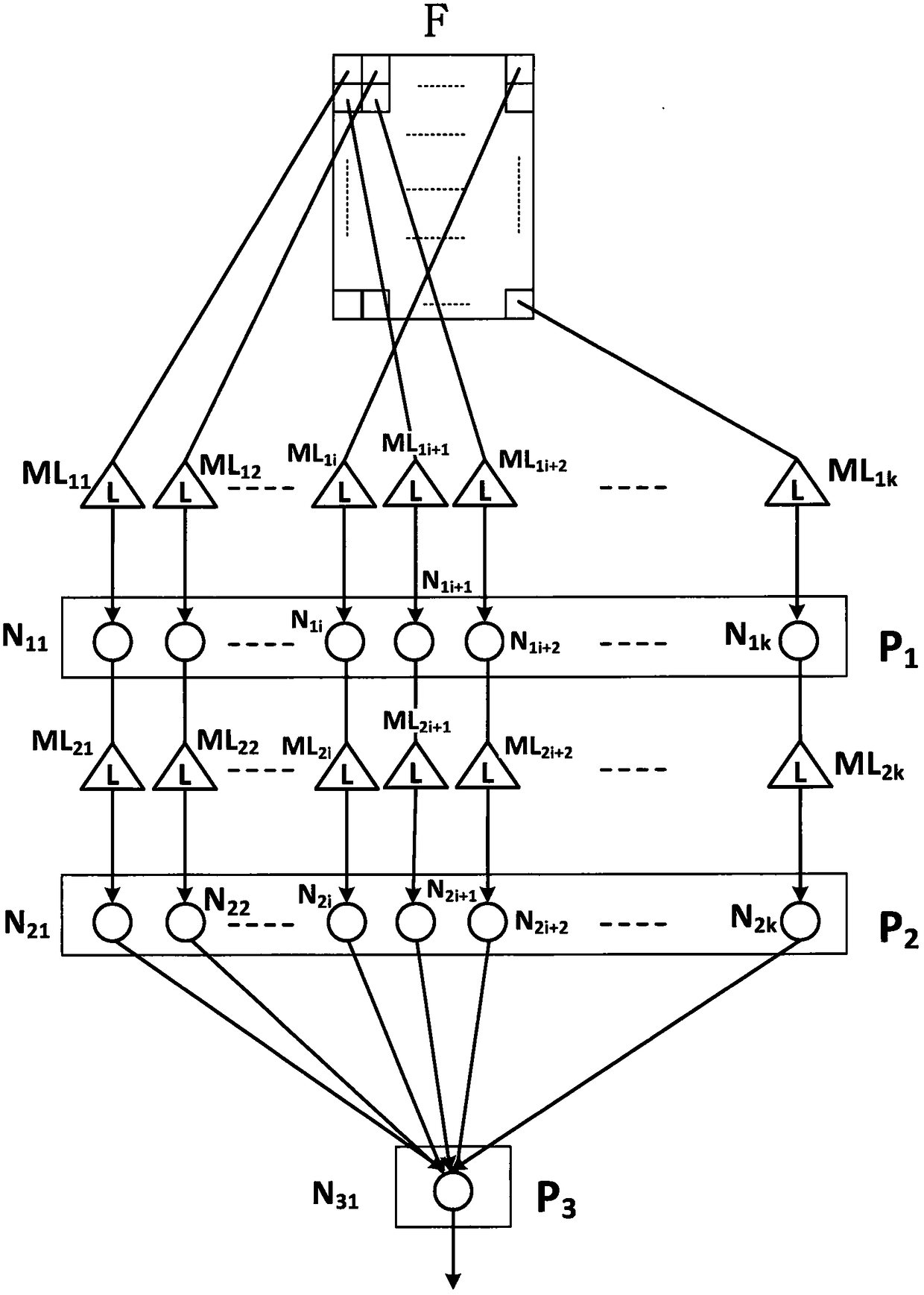

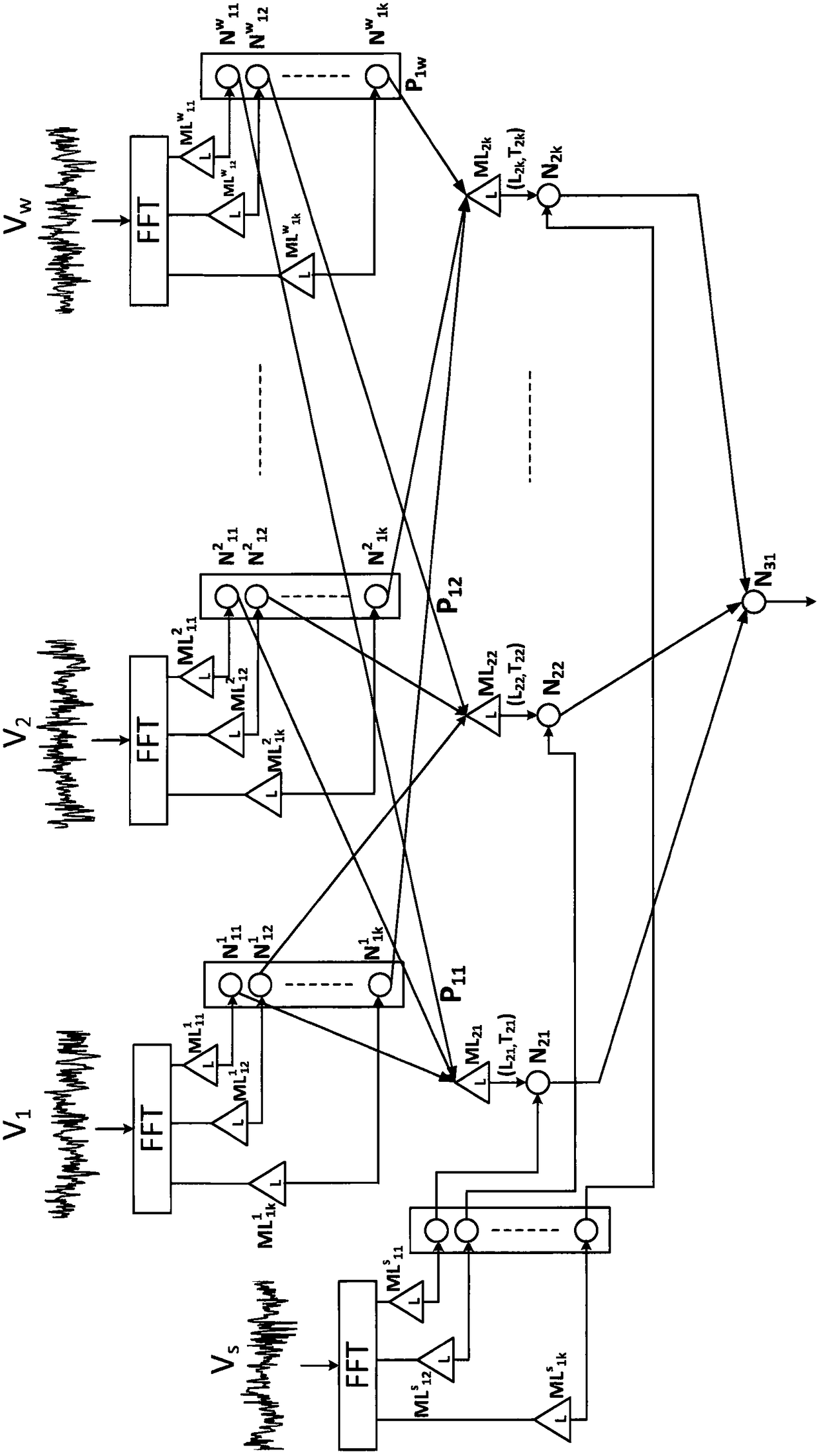

Stock prediction method based on artificial intelligence ultra-deep learning

The invention relates to a stock prediction method based on artificial intelligence ultra-deep learning in the field of information processing. The stock prediction method is characterized in that allinformation related with the prediction is processed through micro machine learning and then sent to each node of input layers; then predicted values and thresholds are generated through micro machine learning and then sent to neural layers; and a brain layer acquires a predicted range according to the predicted values, put forwards a check value, sends the check value to each neural layer for excitement checking and finally acquires an optimal predicted value. The implementation effects are that all factors related with the prediction and prediction effects generated by various mathematicalmodels can be constructed into a prediction platform through ultra-deep learning, and multiple times of machine learning are performed on a prediction result so as to achieve the optimal prediction. Meanwhile, automatic or manual fuzzy parameter correction can be carried out, so that the stock prediction method has a breakthrough in stock prediction.

Owner:天津市阿波罗信息技术有限公司

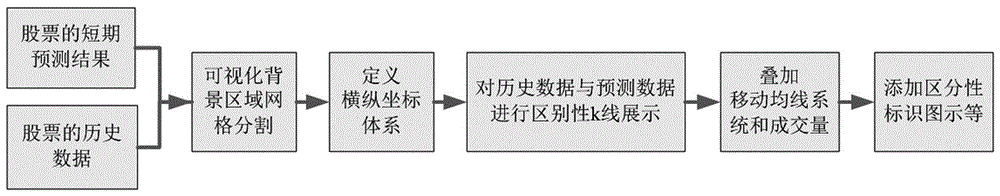

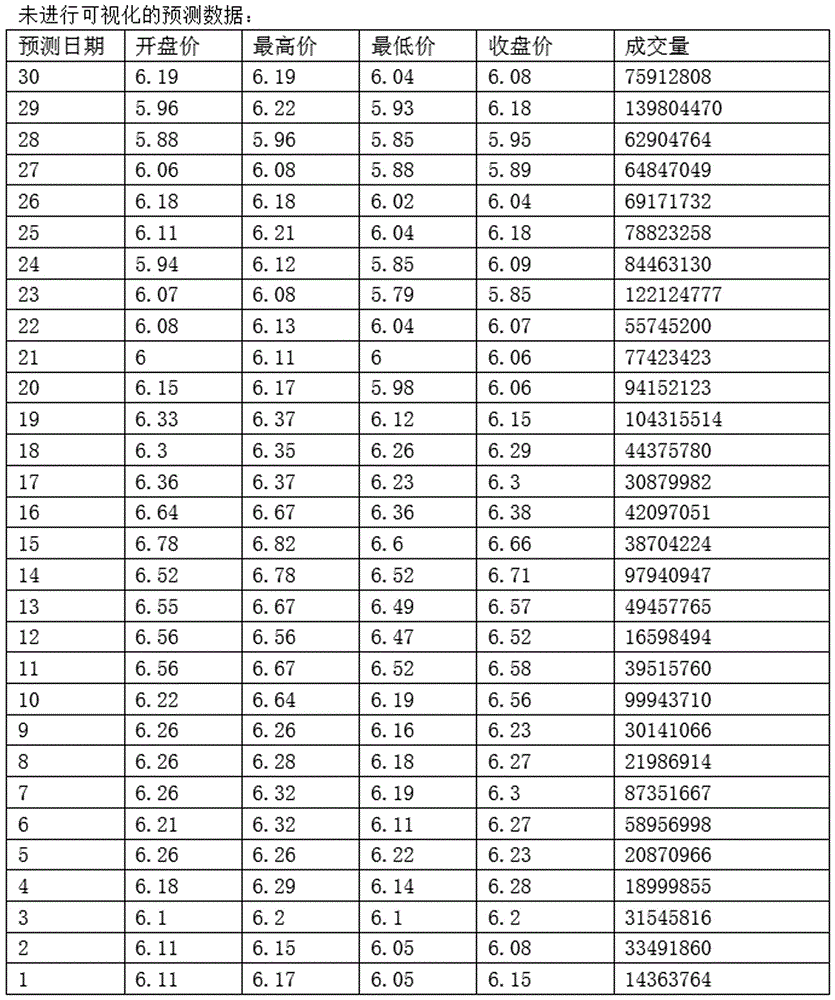

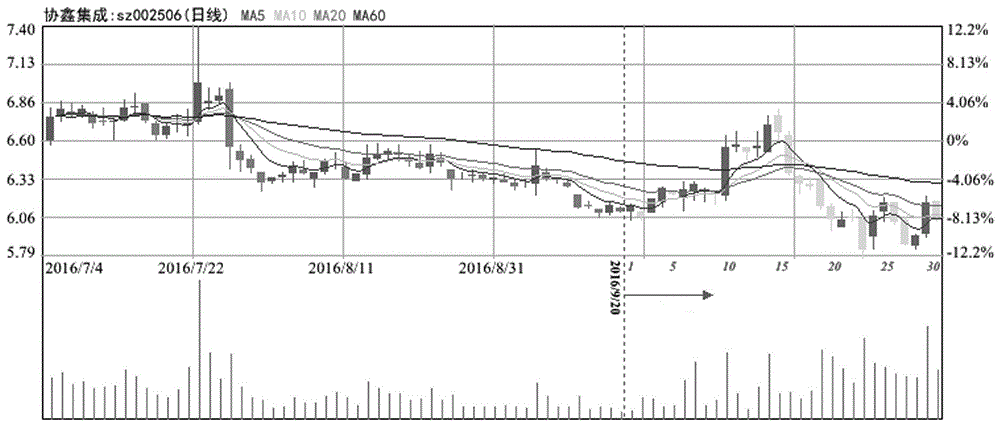

Visual display method for stock trend prediction result

The invention discloses a visual display method for a stock trend prediction result. The visual process of the method is based on a short-term stock prediction result; and short-term prediction indicates prediction of trading days of more than two weeks of stocks, for example, twenty-day prediction, thirty-day prediction, or sixty-day prediction. The prediction data content includes information of an opening price, a highest price, a lowest price, a closing price, and a trading volume and the like of each prediction day. According to the method, with a graphical way, various elements or data are transformed into graphs and are drawn at a chart, so that future trend prediction information of the stock can be expressed clearly and effectively. The method disclosed by the invention can be used for visual displaying of a short-term prediction result of a common stock, so that convenience is provided for the user and a decision-making support is provided for the stock operation by the user.

Owner:洪志令

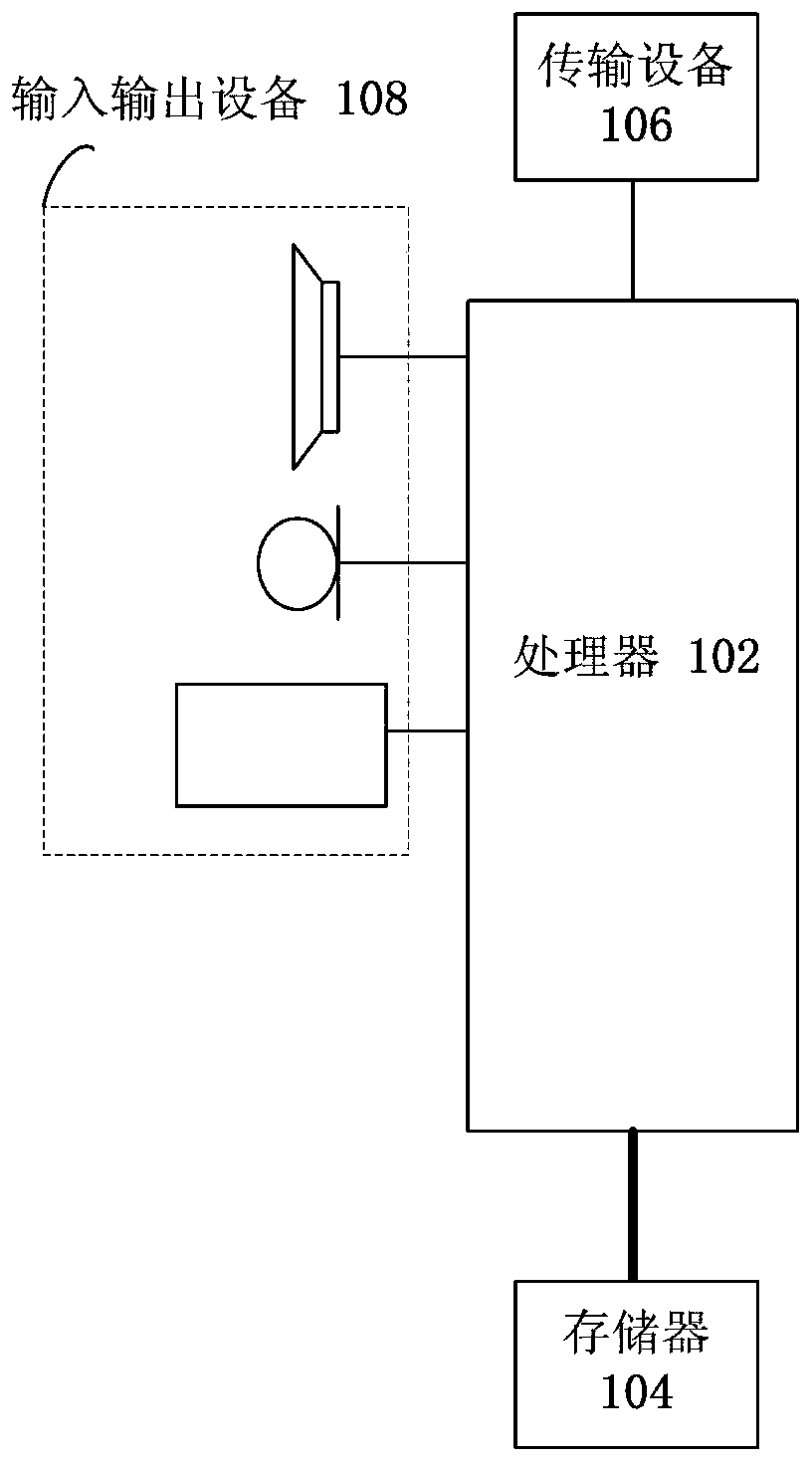

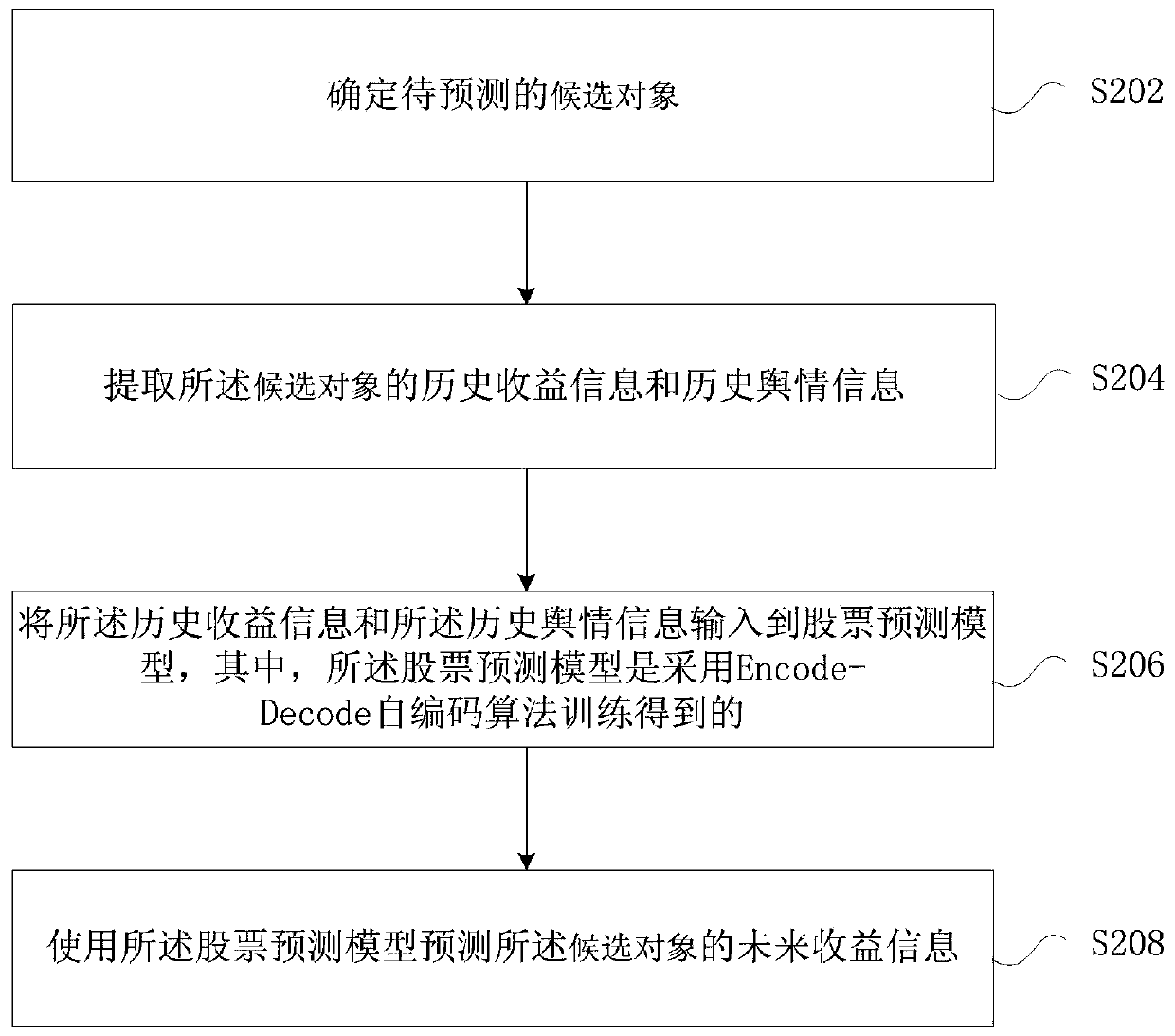

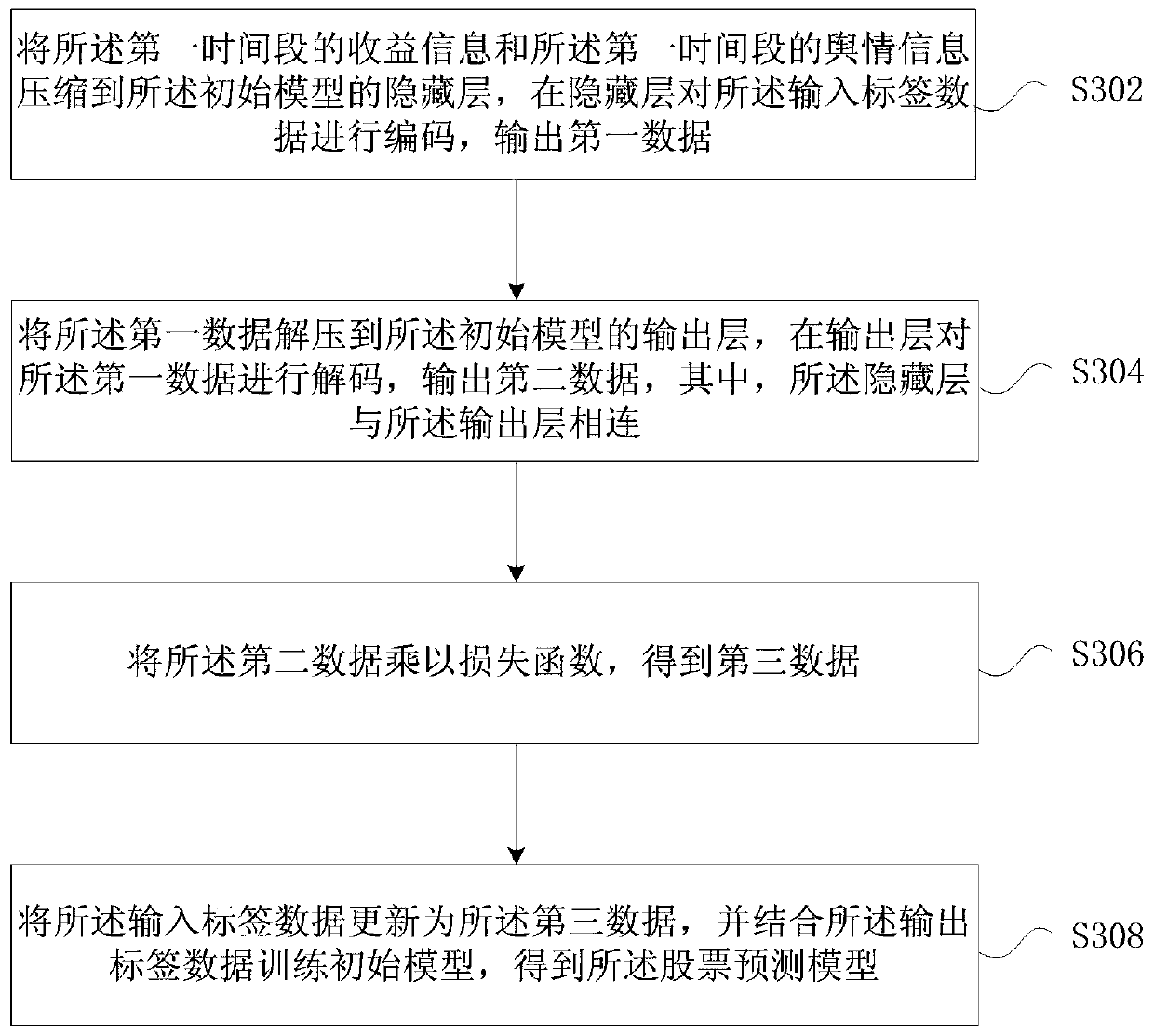

Trend prediction method and device based on artificial intelligence

InactiveCN110414710ASolve technical problems with low accuracyFinanceForecastingEncoding algorithmENCODE

The embodiment of the invention provides a trend prediction method and a device based on artificial intelligence. On one hand, the method comprises the following steps: determining a candidate objectto be predicted; extracting historical revenue information and historical public opinion information of the candidate object; inputting the historical revenue information and the historical public opinion information into a stock prediction model, the stock prediction model being obtained by training using an Encode-Decode self-encoding algorithm; and predicting future income information of the candidate object by using the stock prediction model. According to the method and the device, the technical problem of low accuracy of stock prediction through a linear model in the prior art is solved.

Owner:PING AN TECH (SHENZHEN) CO LTD

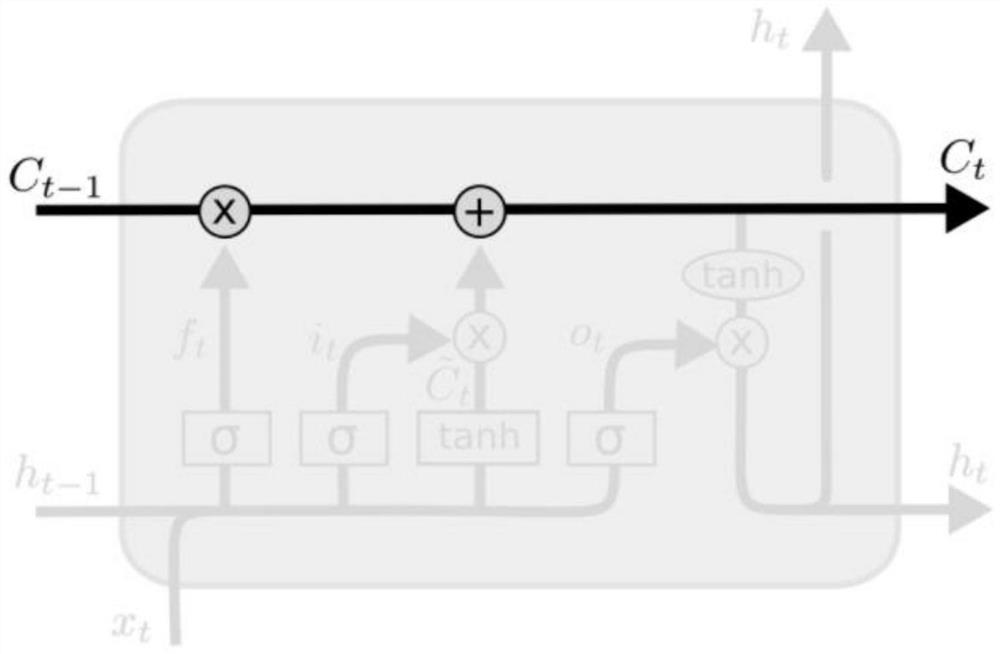

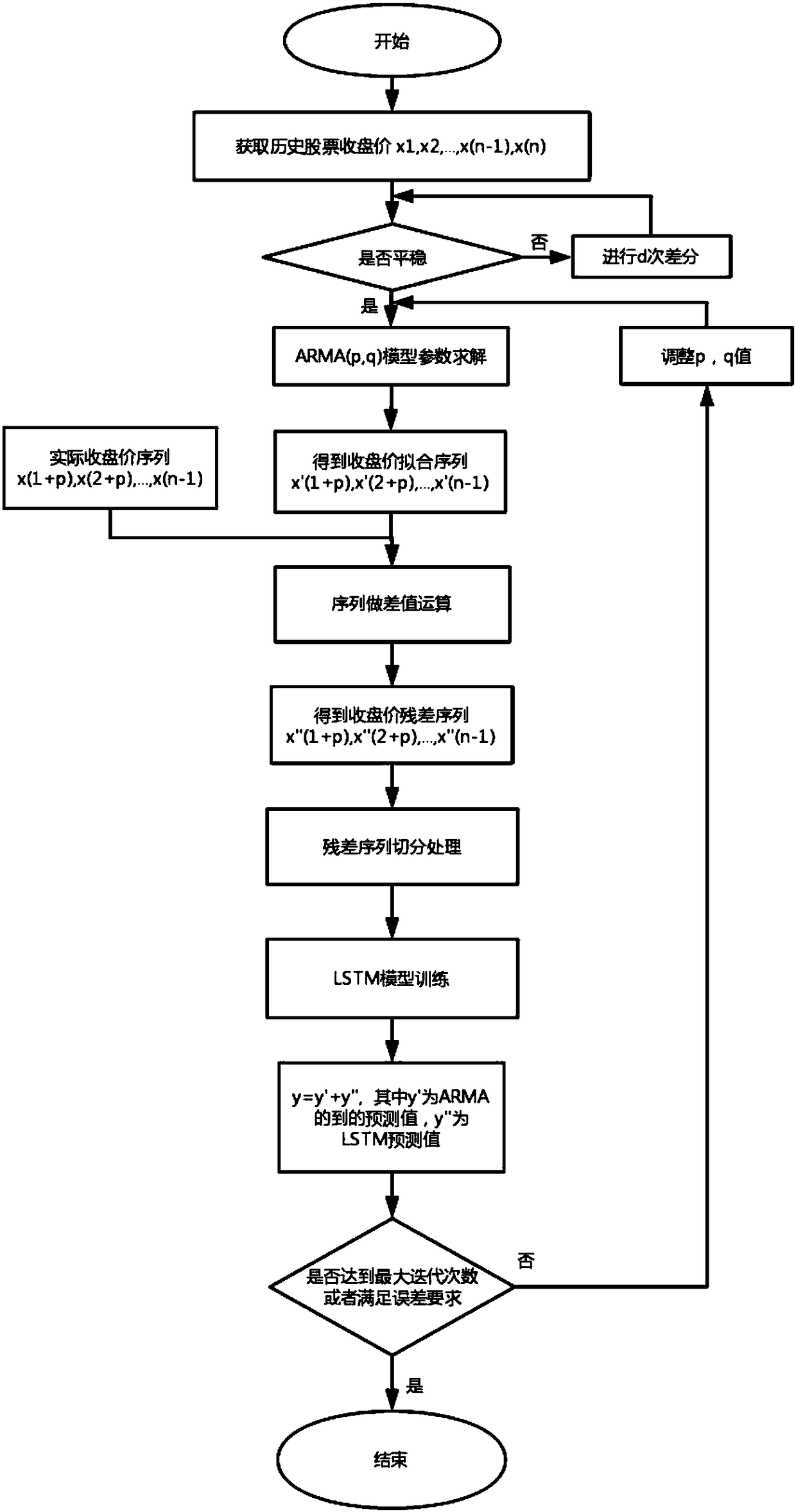

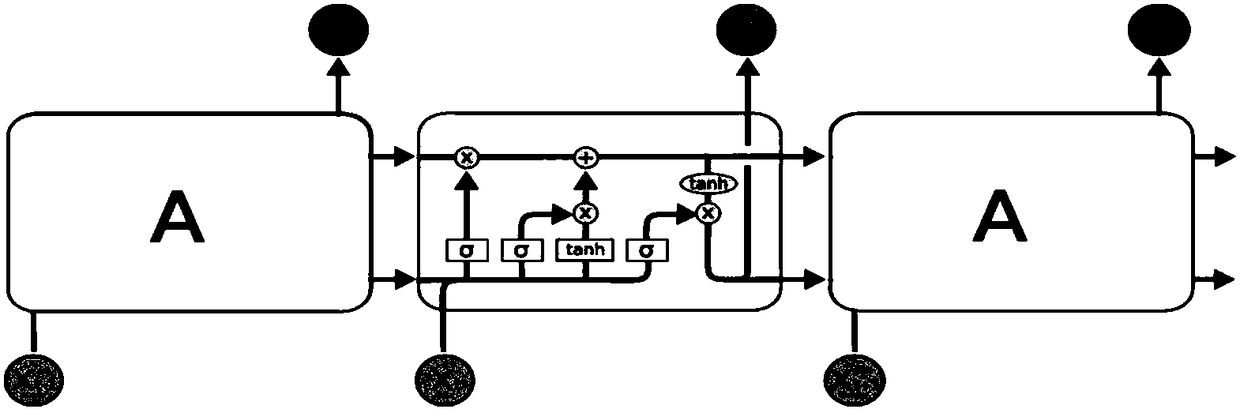

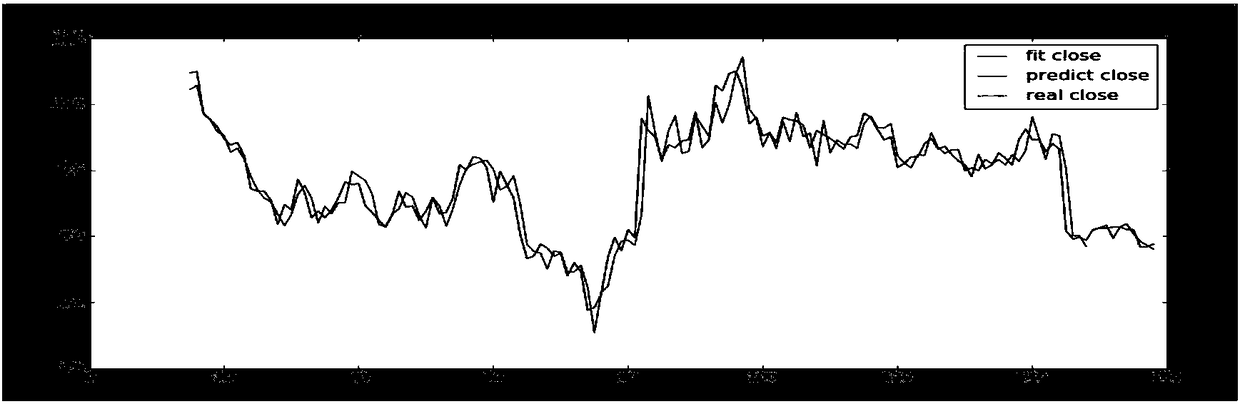

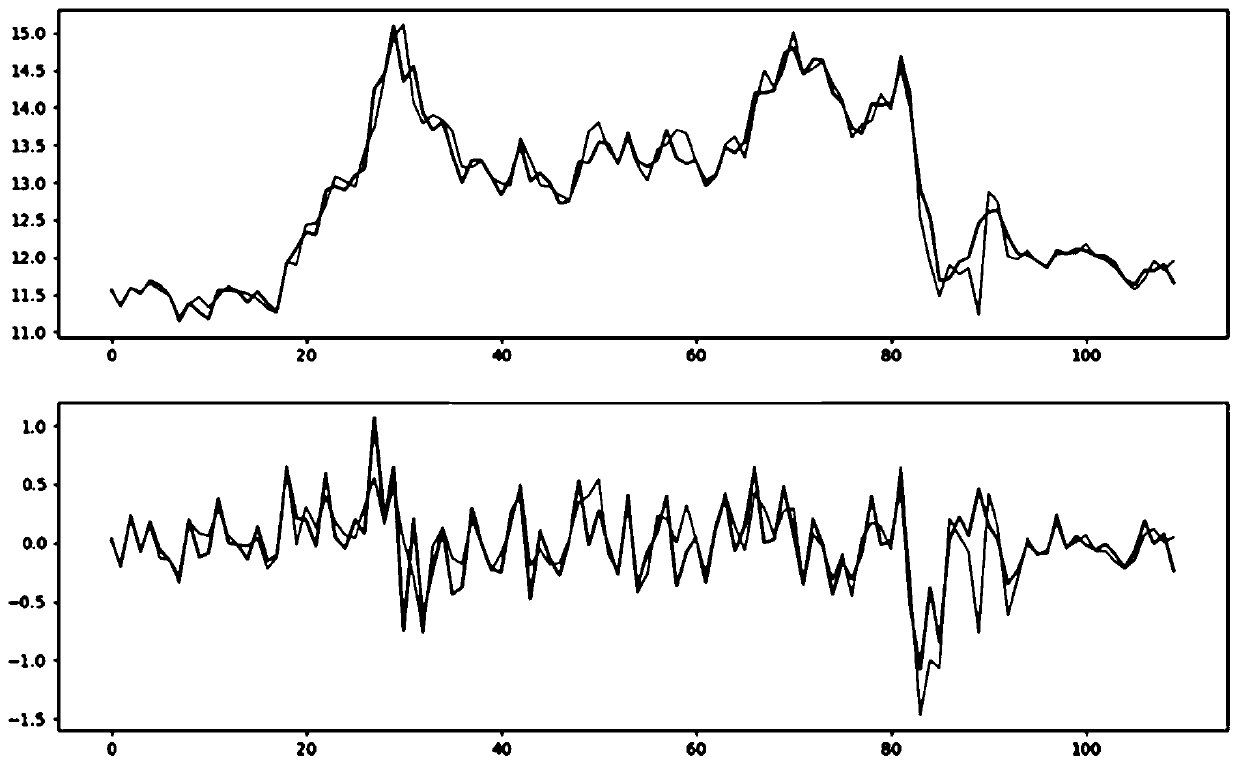

Stock prediction method based on ARMA-LSTM model

InactiveCN108154264AReduce the impactReduce mistakesMarket predictionsFinanceLinear correlationAlgorithm

The invention provides a stock prediction method based on an ARMA-LSTM model, and the method comprises the steps: carrying out the regression fitting and prediction of the stock sequence data throughan ARMA model, carrying out the training and prediction of a residual error sequence through an LSTM model, and finally adding the two results as a final prediction result. The stock transaction datais related with the historical data, and comprises a linear correlation part and a nonlinear correlation part, so the method achieves the fitting of the data sequence through employing the ARMA modelin advance, and the linear part of the data sequence is extracted, thereby speeding up the convergence of the LSTM training, and improving the prediction capability of the LSTM for the nonlinear partso as to reduce the local convergence phenomena.

Owner:BEIJING UNIV OF TECH

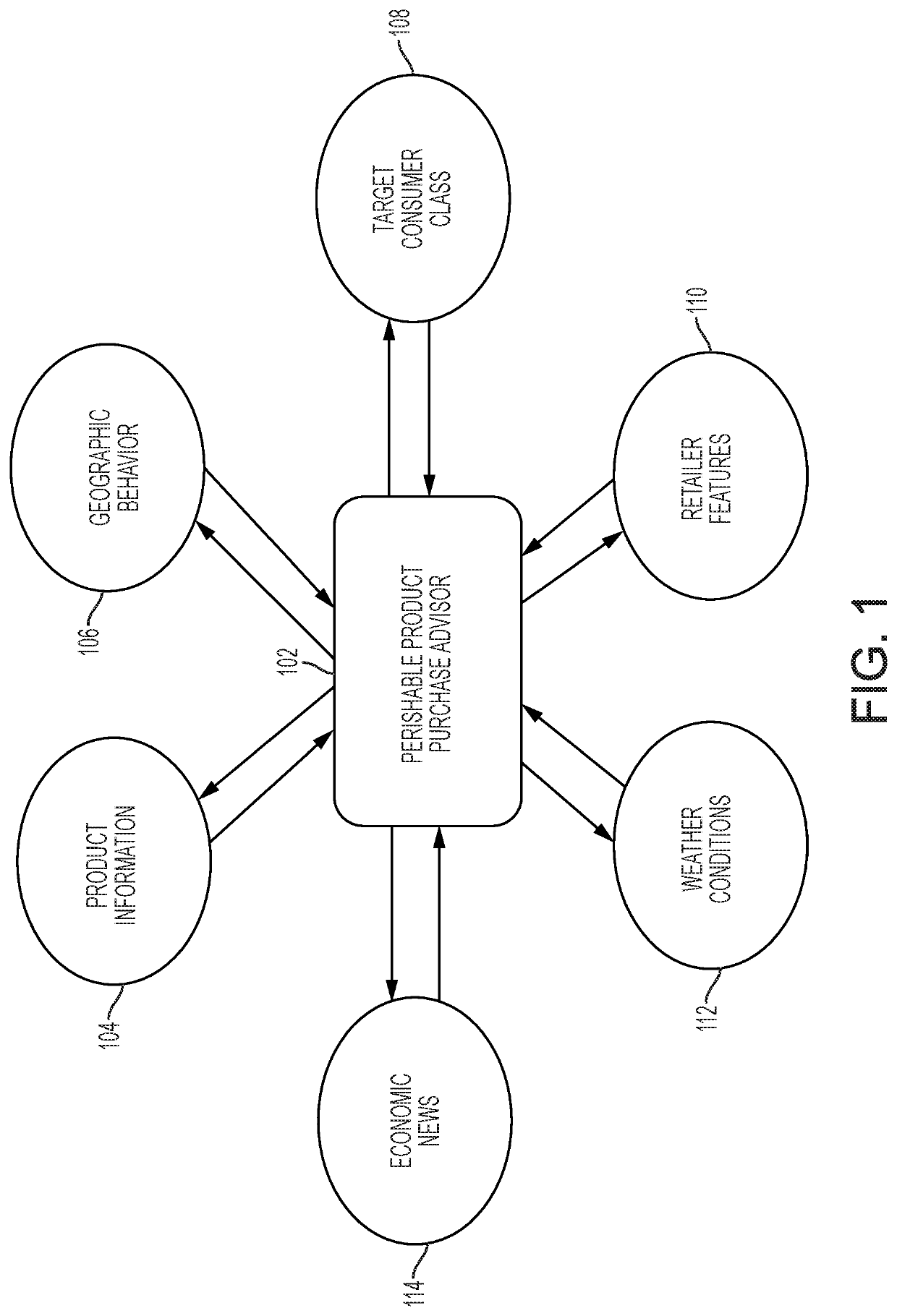

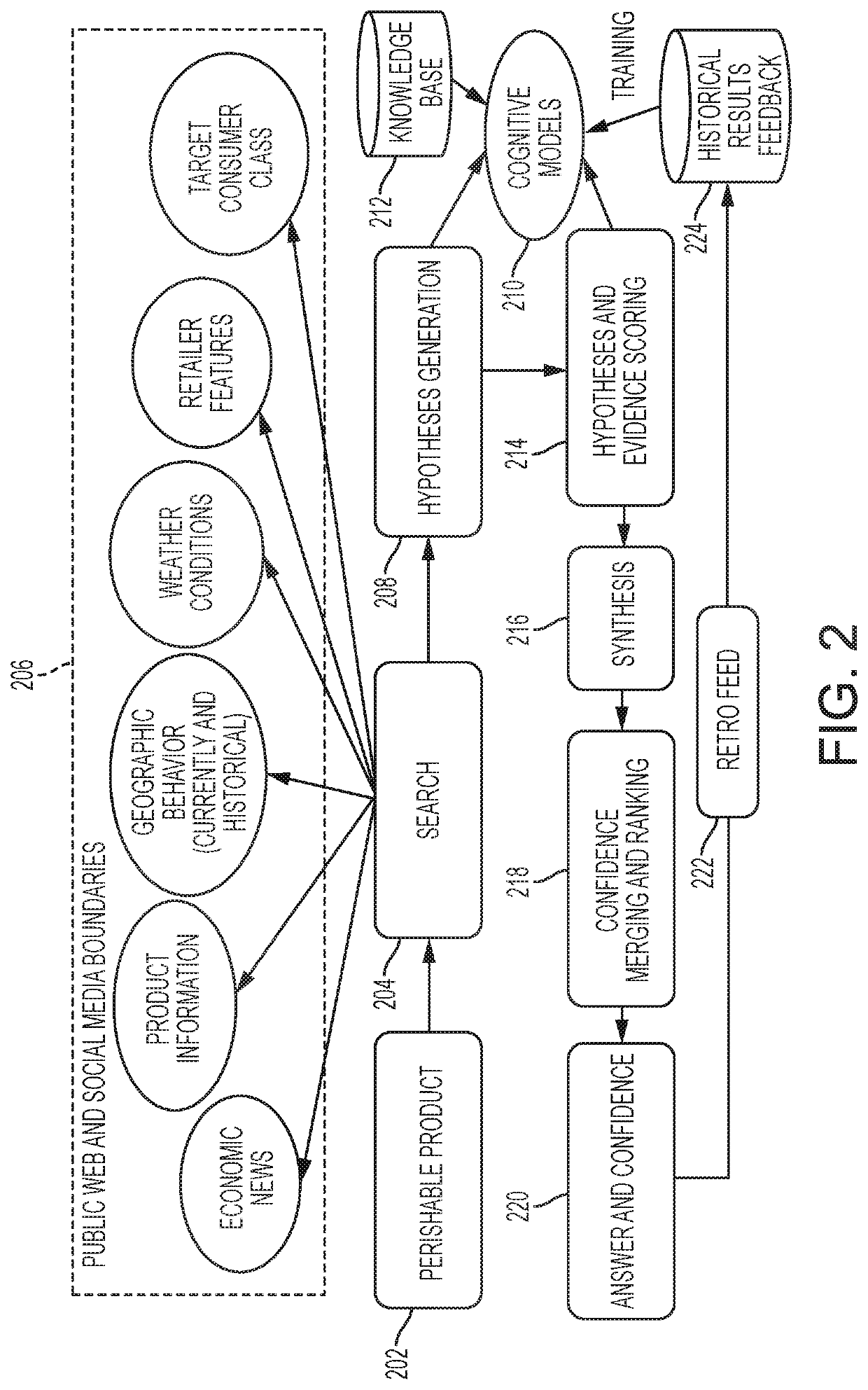

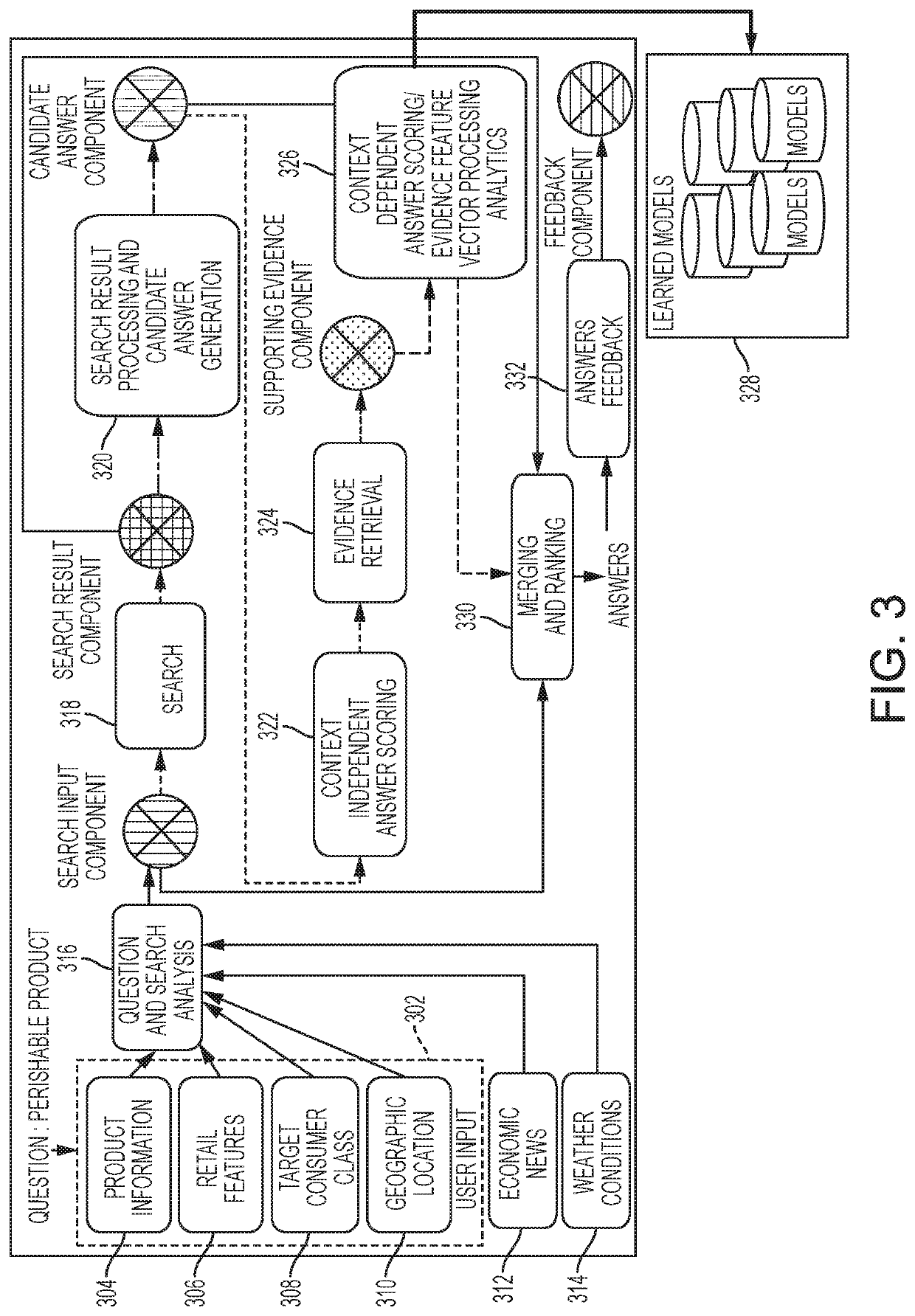

Method to analyze perishable food stock prediction

Predicting perishable food stock quantity for replenishment. A search strategy is created for searching at least unstructured data along multiple dimensions based on the user input. A search of a network of computers is performed according to the search strategy. A machine learning model associated with a dimension is invoked, for each of the multiple dimensions. The machine learning model outputs a replenishment quantity along each of the multiple dimensions. The replenishment quantities of the multiple dimensions are merged to provide a predicted suggestion.

Owner:KYNDRYL INC

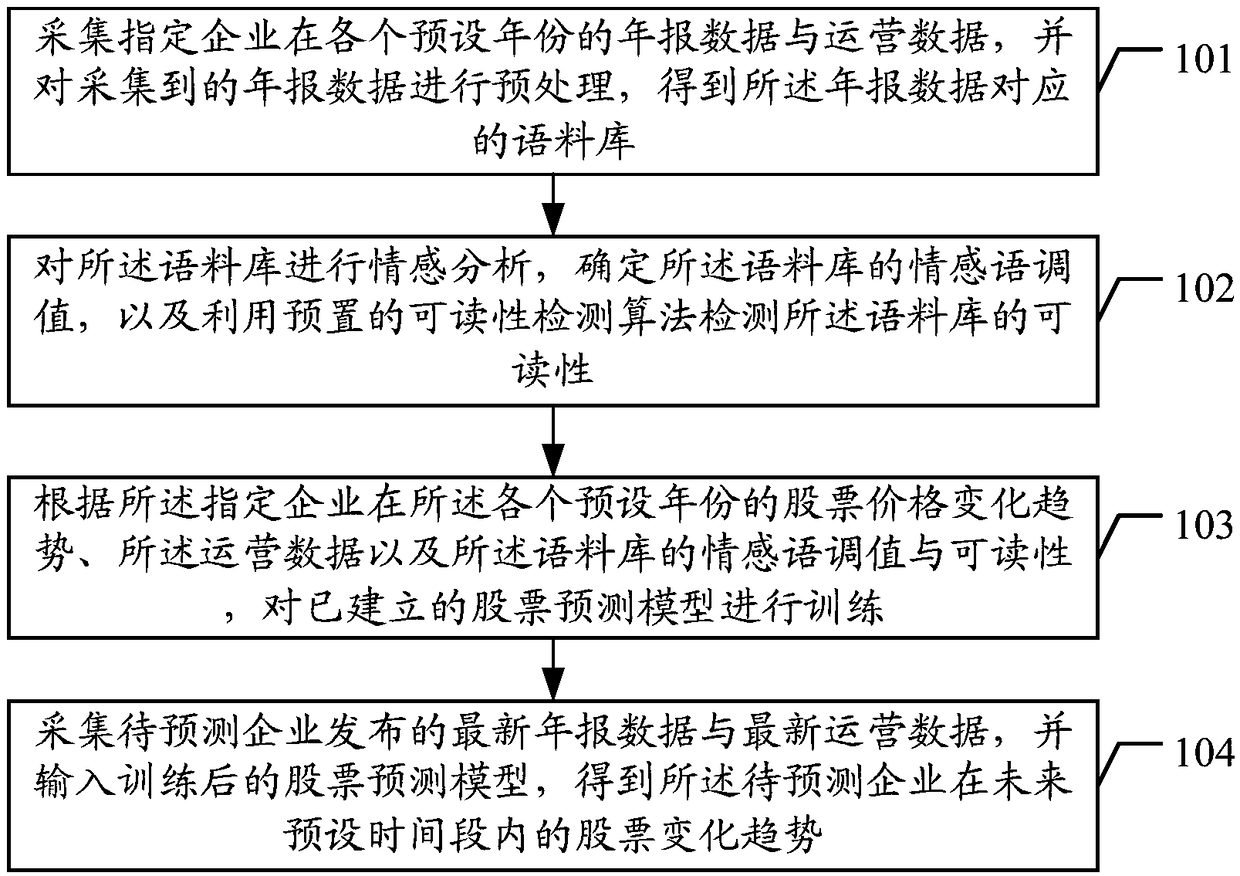

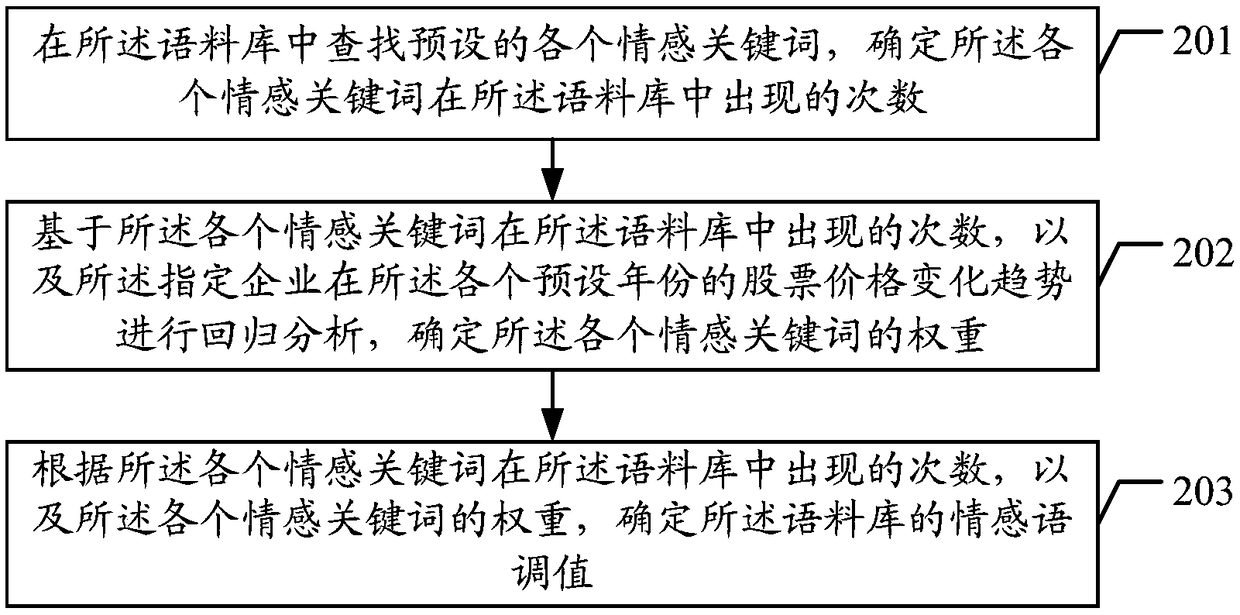

Method and device for predicting stock trend, electronic device, and storage medium

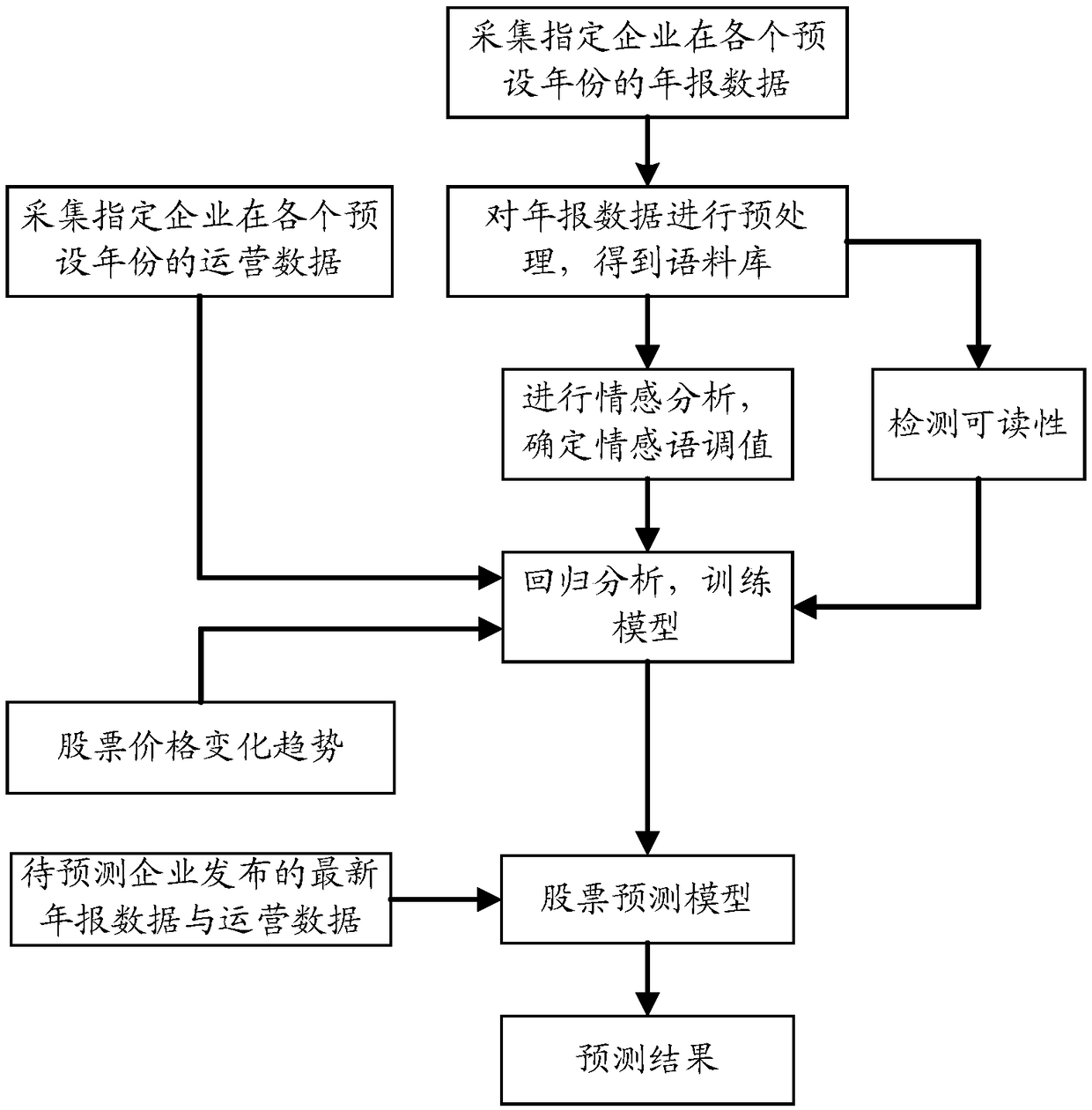

The invention discloses a method and device for predicting a stock trend. The method comprises: collecting annual report data and operation data of a designated enterprise in each preset year and preprocessing the collected annual report data to obtain corpuses corresponding to all annual report data; carrying out an emotional analysis on each corpus, determining an emotional intonation value of each corpus, and detecting readability of each corpus by using a preset readability detection algorithm; according to stock price change trends and operation data of the designated enterprise in all preset years as well as the emotional intonation values and readability of all corpuses, training an established stock prediction model; and collecting latest annual report data and latest operational data released by a to-be-predicted enterprise and inputting the collected data into the trained stock prediction model to obtain a stock changing trend of the to-be-predicted enterprise within a presetperiod of time in future. Therefore, the stock prediction result becomes accurate and the stock prediction accuracy is improved.

Owner:SHENZHEN UNIV

Data prediction method of combined LSTM model based on two-dimensional data stream

PendingCN110135624AImprove robustnessStrong abstraction abilityFinanceForecastingRelational modelFeature extraction

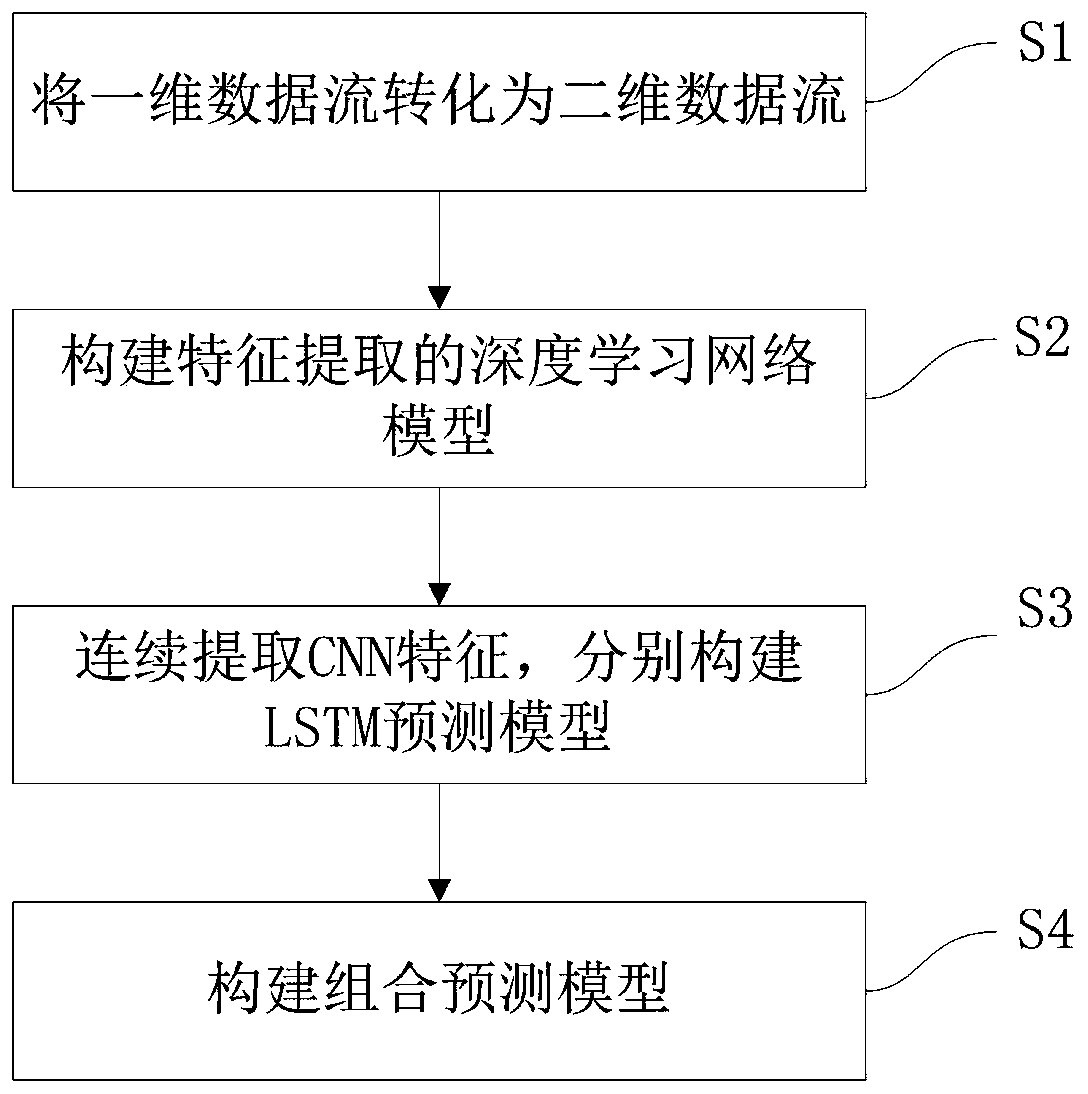

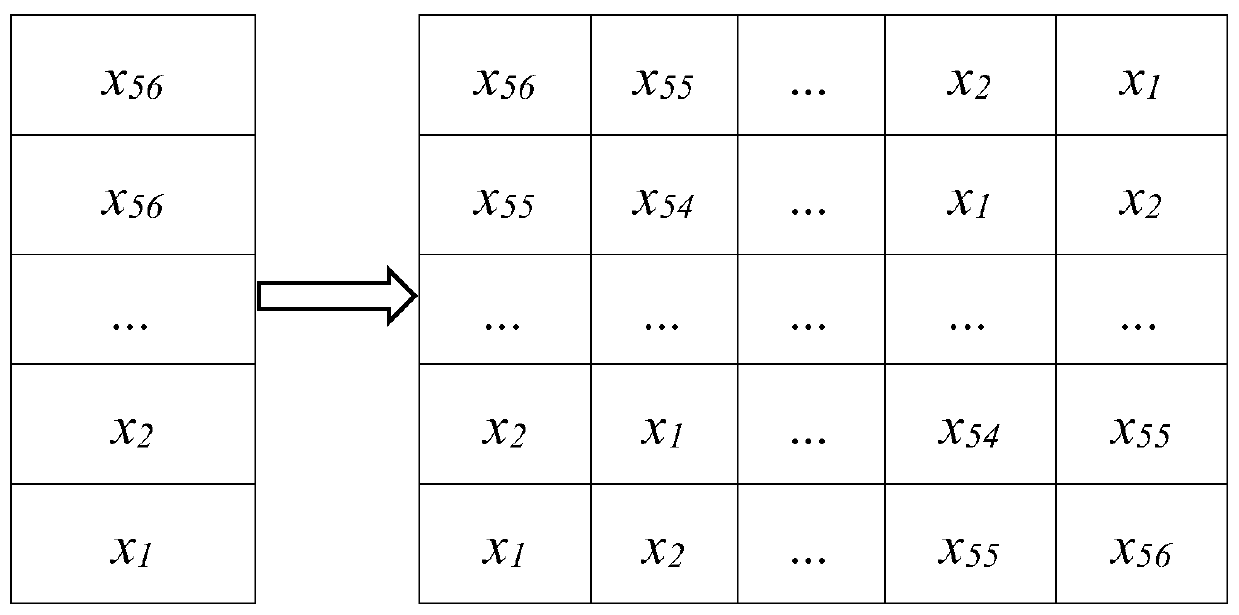

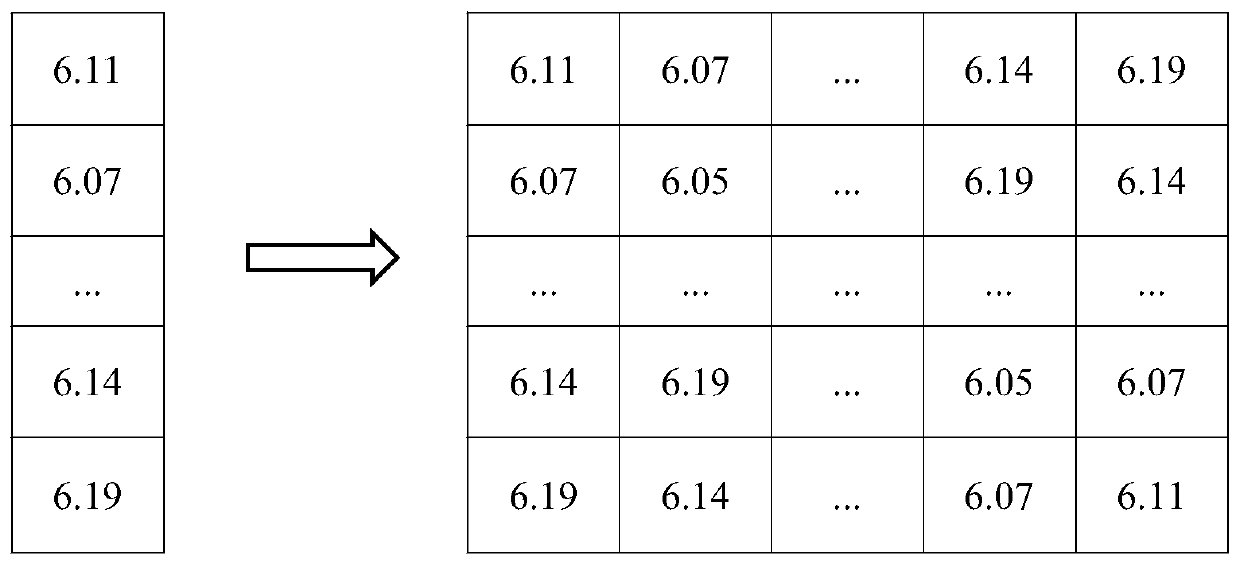

The invention provides a stock prediction method of a combined LSTM model based on a two-dimensional data stream. The method comprises the following steps of converting one-dimensional stock sequencedata flow into a two-dimensional data flow containing time context information; carrying out feature extraction on the two-dimensional data flow by using a convolutional neural network; then respectively establishing an LSTM prediction model of a single stock price, a stock market index and an involved industry index on the two-dimensional data stream; and predicting a single stock price, a stockmarket index and an involved industry index by using the respective LSTM model, then establishing a relationship model between the single stock and the stock market index and between the single stockand the involved industry index respectively, and forming a combined prediction model on the basis of the relationship model. The stock prediction method of the combined LSTM model based on the two-dimensional data flow has good robustness.

Owner:WUHAN UNIV OF SCI & TECH

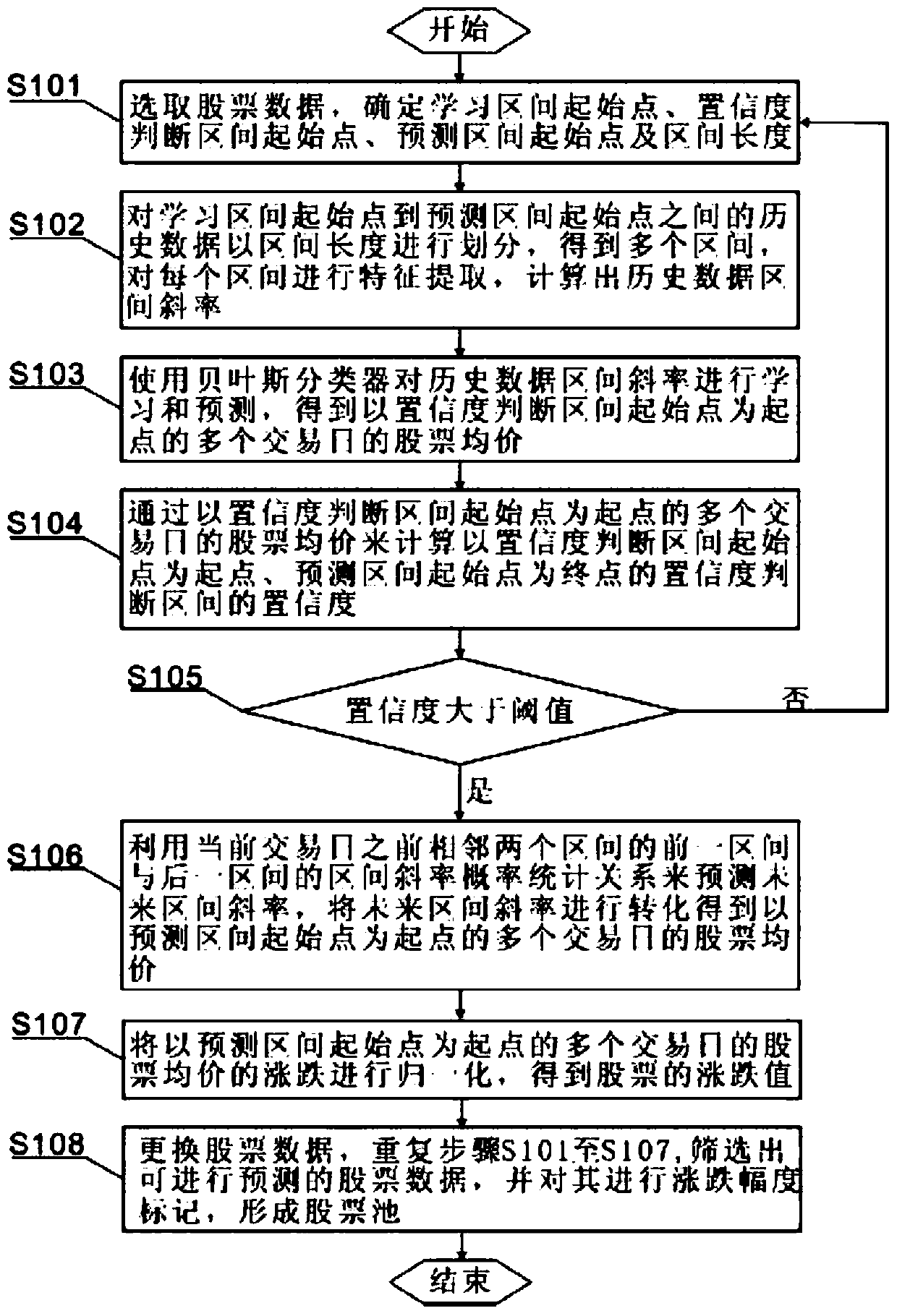

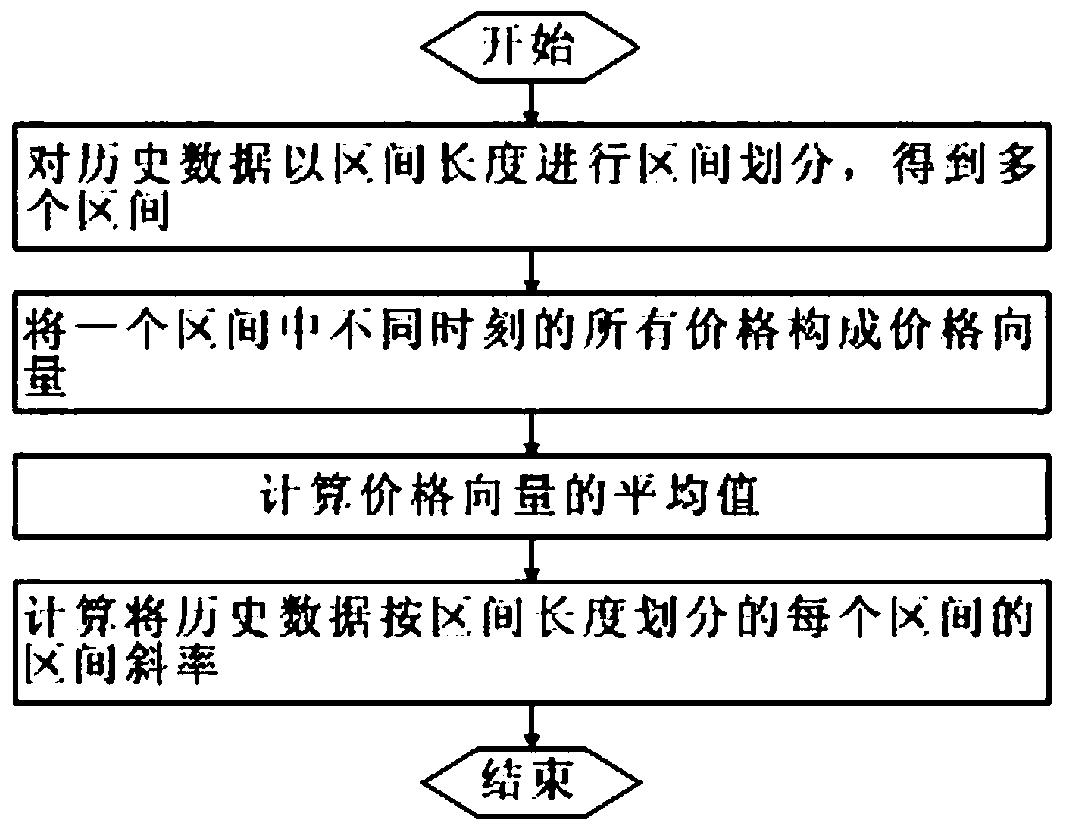

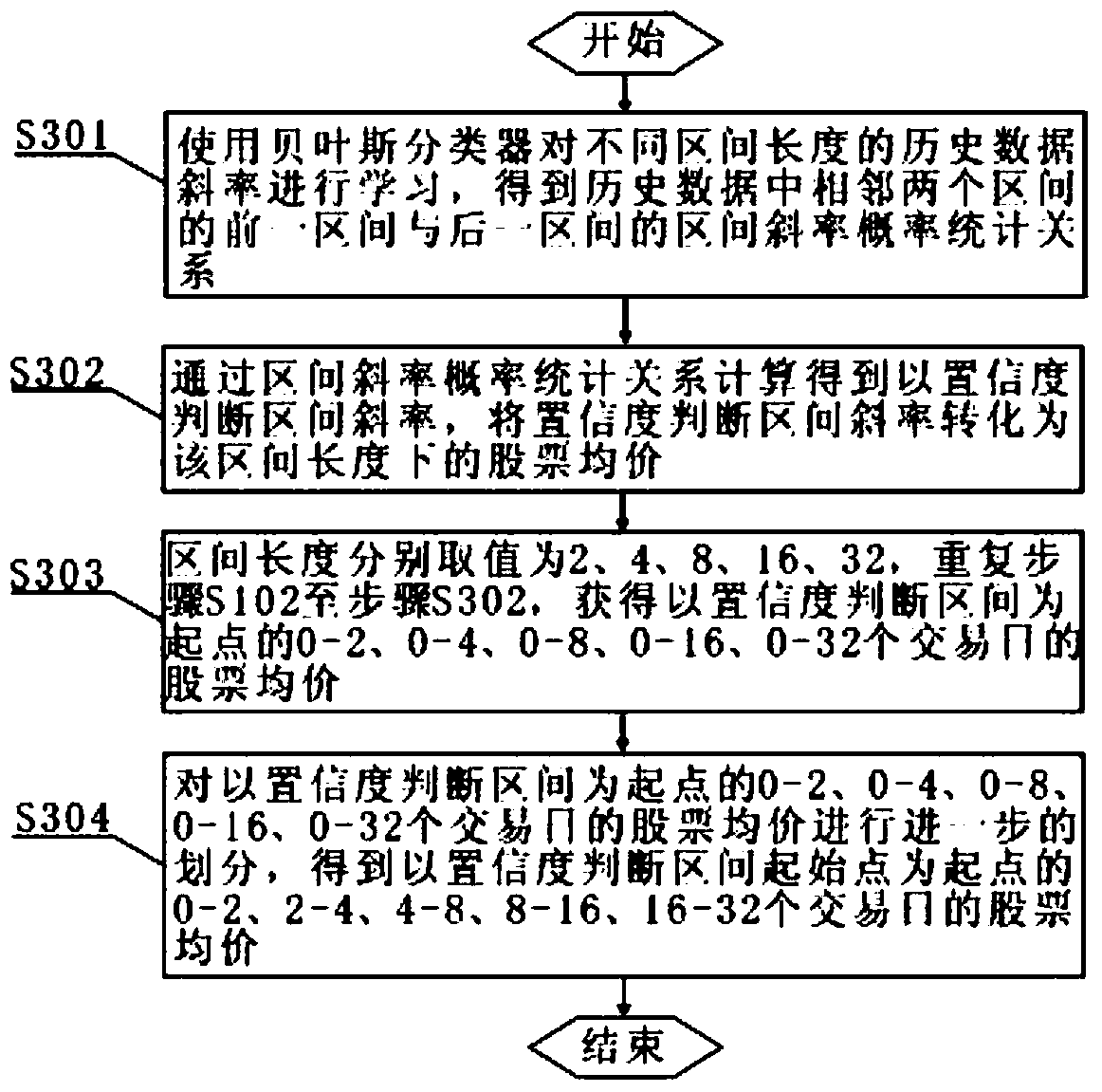

Medium and long-term stock trend prediction method and system based on Bayesian classifier

ActiveCN104751363BEasy to captureEffective assessmentFinanceCharacter and pattern recognitionData miningLong term trend

The invention relates to a medium and long-term stock trend prediction method based on a Bayesian classifier, comprising: selecting stock data, determining each starting point and interval length dj; dividing intervals, and calculating the interval slope of historical data; Carry out learning and predict the confidence judgment interval, and obtain the average stock price of multiple trading days starting from the starting point of the confidence judgment interval; calculate the confidence degree, and compare the confidence degree with the preset threshold; predict the future Interval slope, convert the future interval slope into the average stock price of multiple trading days starting from the starting point of the forecast interval; normalize the rise and fall of the average stock price of multiple trading days starting from the starting point of the forecast interval , to get the ups and downs of the stock; build a stock pool. The invention avoids accumulative errors, shows stock trend changes within the prediction interval, better captures stock market fluctuation trends, and more effectively evaluates transaction risks.

Owner:BEIJING TECHNOLOGY AND BUSINESS UNIVERSITY

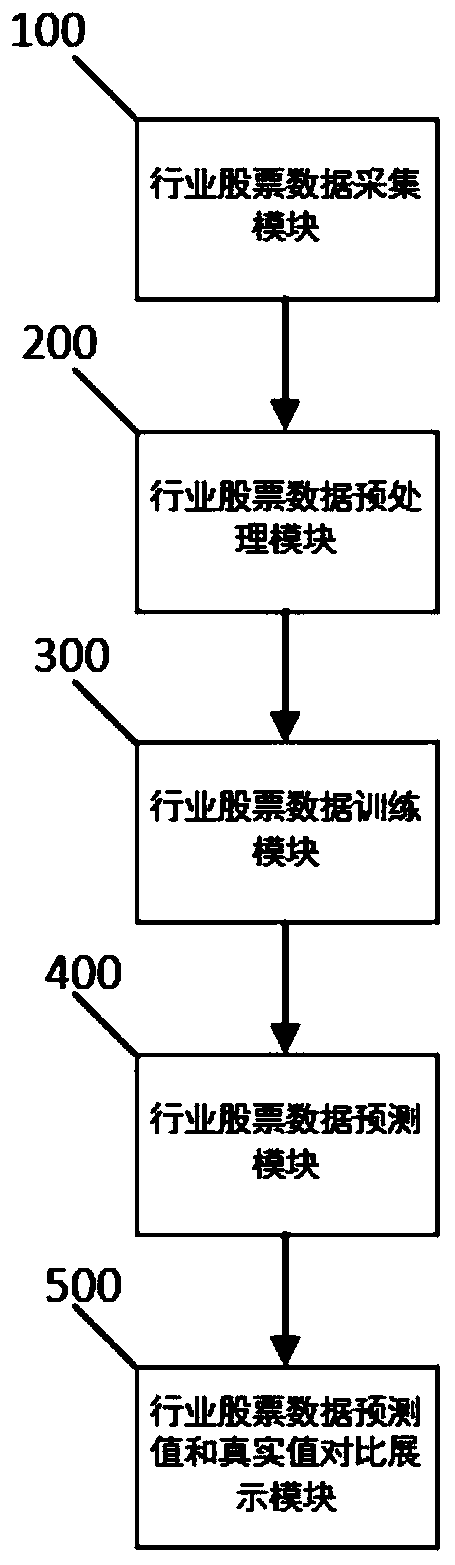

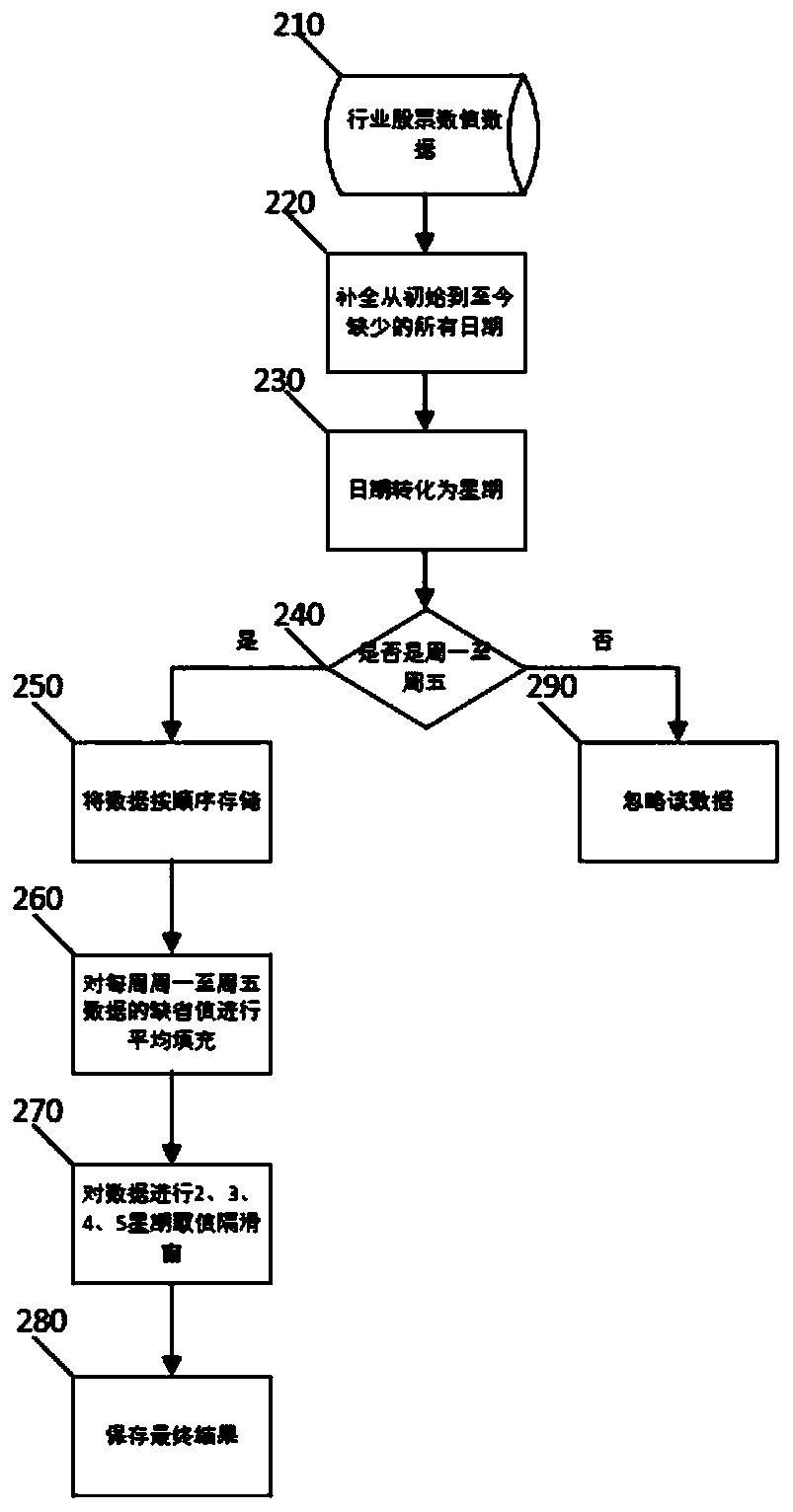

Financial prediction method and system

InactiveCN110264013AImprove accuracyQuick understandingFinanceForecastingData acquisitionData prediction

The invention discloses a financial prediction method. The invention discloses a system for predicting stock in the financial field industry, which can improve the stock prediction accuracy and help a user to quickly know the trend of the stock of the next week. The system comprises an industry stock data acquisition module, an industry stock data preprocessing module, an industry stock data training module, an industry stock data prediction module, an industry stock prediction value and a true value comparison display module.

Owner:苏州派维斯信息科技有限公司

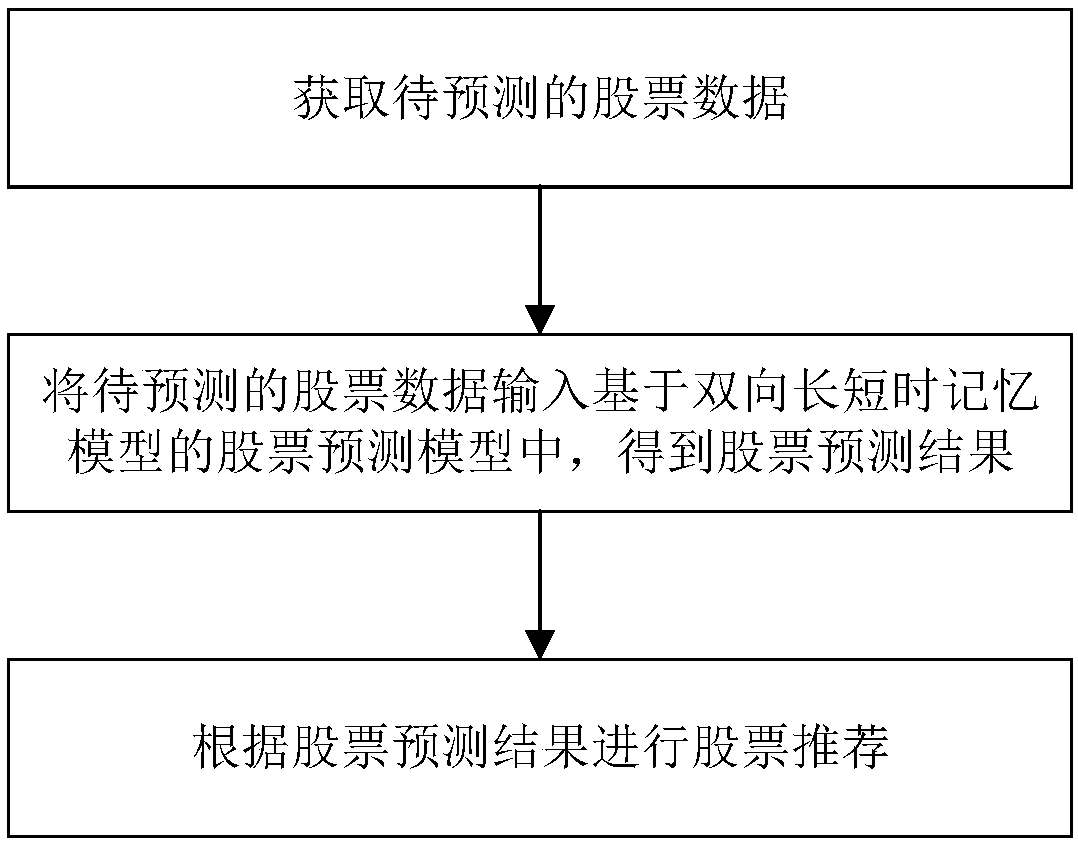

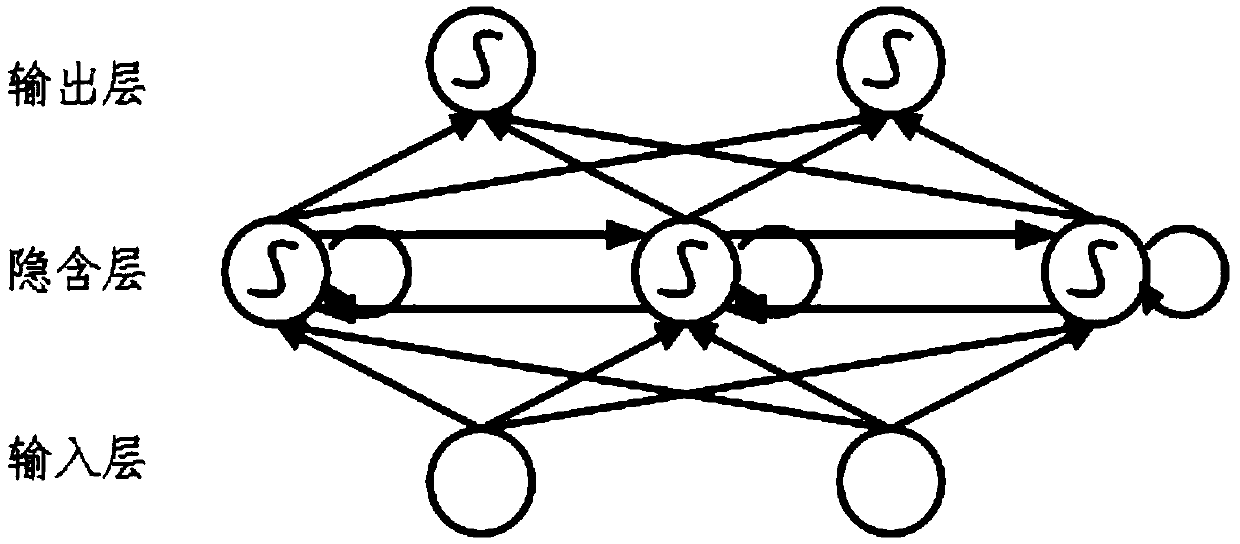

A stock recommendation method and system based on a bidirectional long-short-term memory model

The invention discloses a stock recommendation method and system based on a bidirectional long-short time memory model. The method comprises the steps of obtaining stock data to be predicted; Inputting the stock data to be predicted into a stock prediction model based on a bidirectional long-short time memory model to obtain a stock prediction result; And performing stock recommendation accordingto the stock prediction result. According to the invention, stock prediction is carried out through a bidirectional long-short time memory model which is a neural network with time performance; According to the stock recommendation method based on deep learning, the context relation in the forward time direction and the backward time direction of the time sequence is fully utilized, the influenceof time factors on stock fluctuation is considered, and compared with a traditional stock recommendation method based on deep learning, a stock prediction and recommendation result with higher precision can be provided. The method can be widely applied to the field of financial data mining.

Owner:广州市大智网络科技有限公司

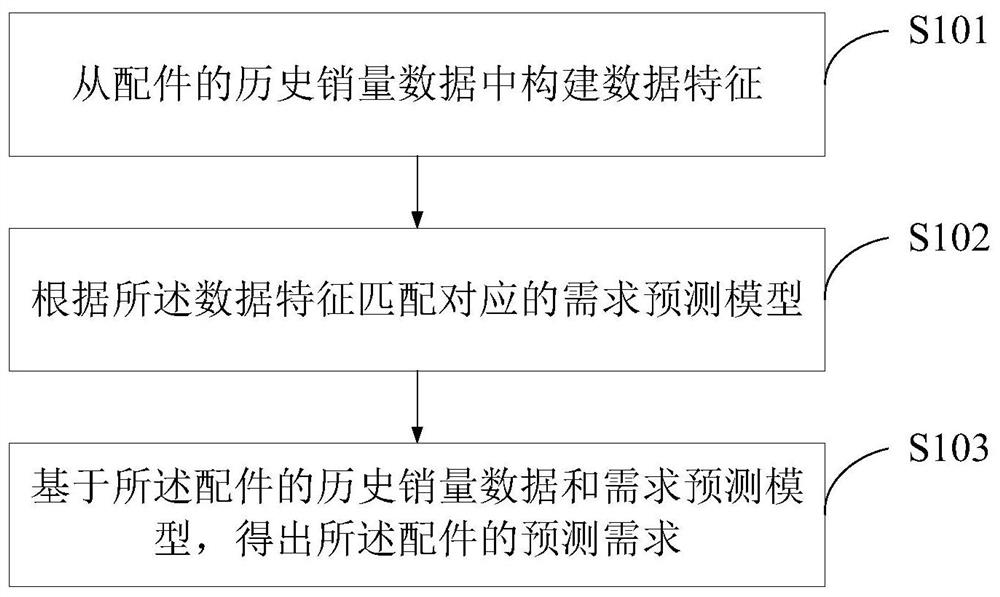

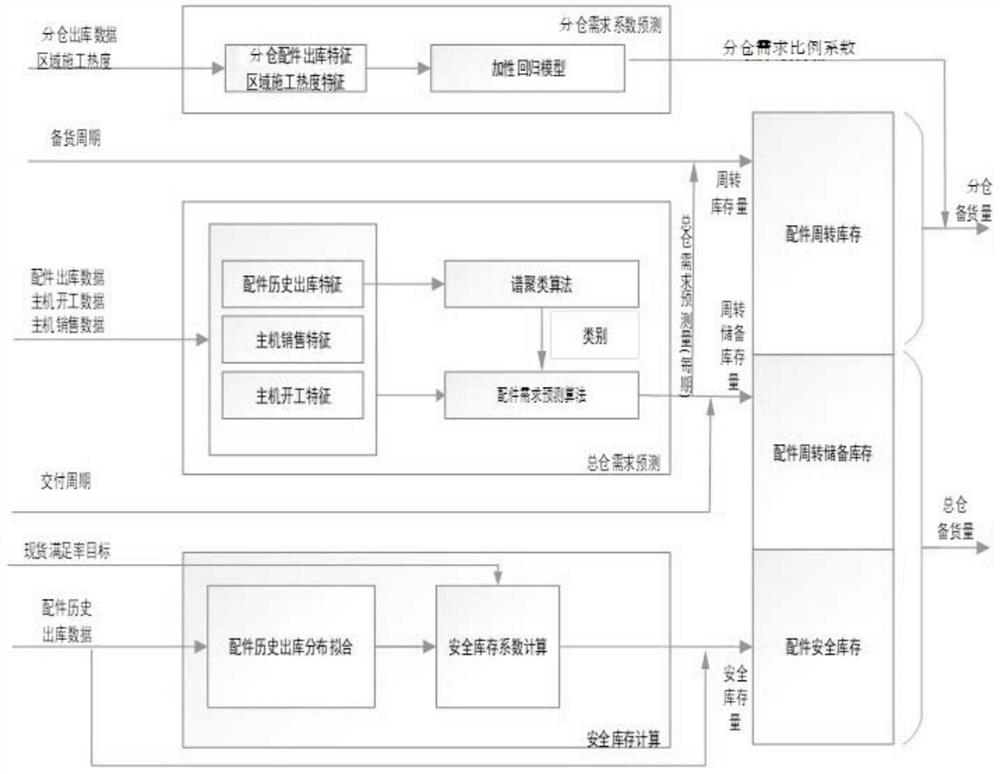

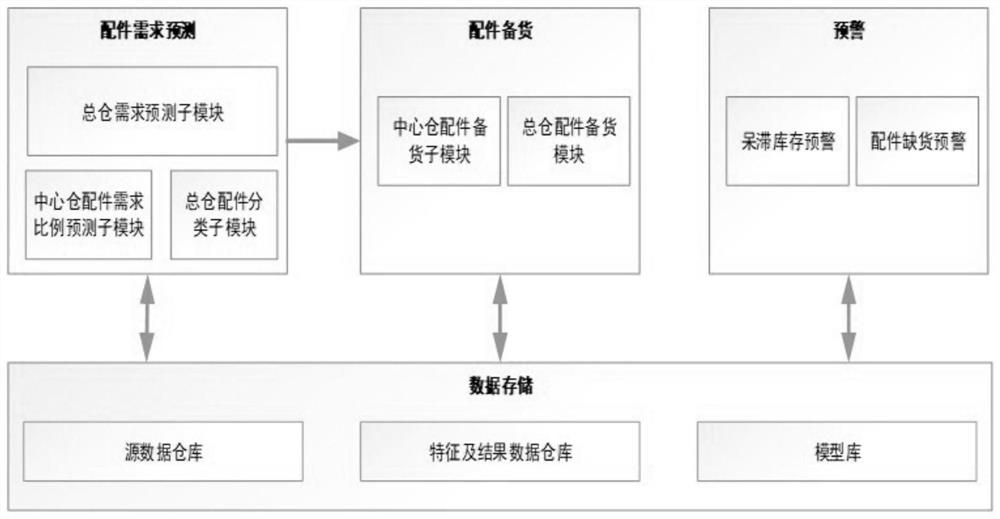

Engineering machine part stocking prediction method, management method and system

PendingCN113962416AImprove accuracyImprove forecast accuracyForecastingCharacter and pattern recognitionMachine partsIndustrial engineering

The embodiment of the invention provides an engineering machine part stocking prediction method. The prediction method comprises the following steps: constructing data features from historical sales volume data of parts; matching a corresponding demand prediction model according to the data features; and obtaining a prediction demand of the accessory based on the historical sales data of the accessory and a demand prediction model. Meanwhile, the invention further discloses a corresponding engineering machine part stock management method and system. According to the embodiment of the invention, the method and system solves a problem that a single prediction model is poor in adaptability to different types of engineering machinery parts, and improves the efficiency of stocking management of the engineering machinery parts and the economical efficiency and accuracy of stocking.

Owner:中科云谷科技有限公司 +1

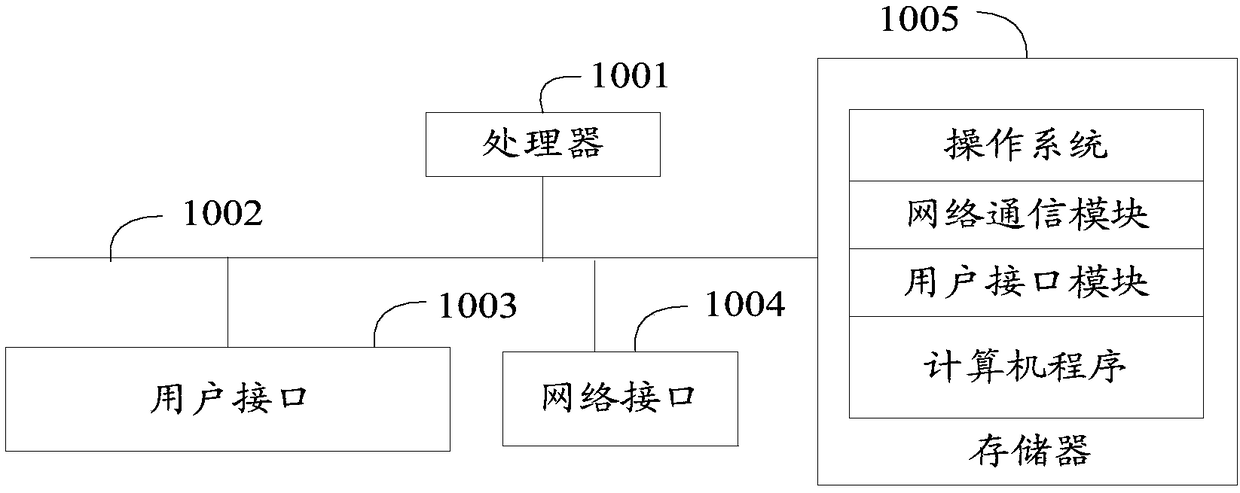

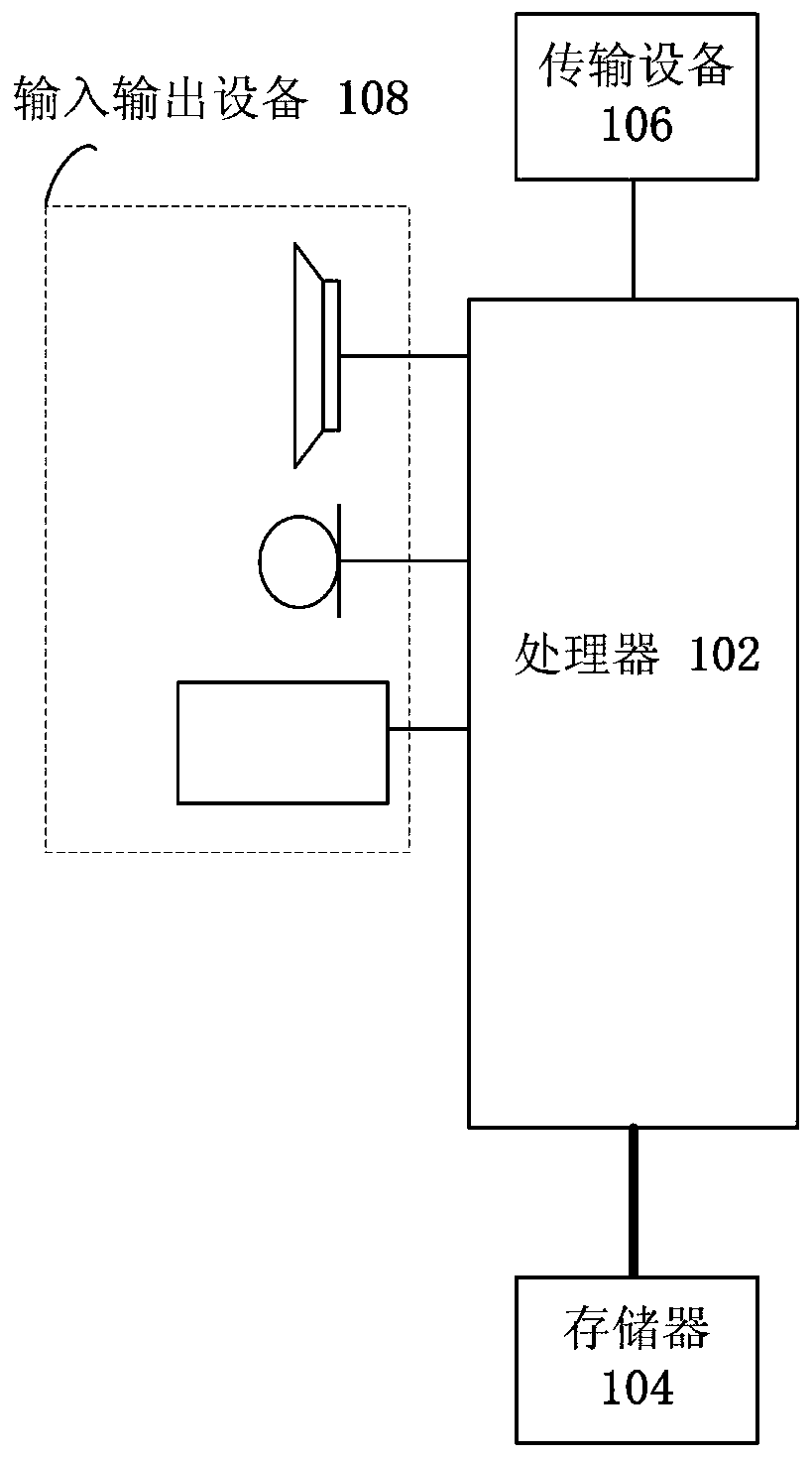

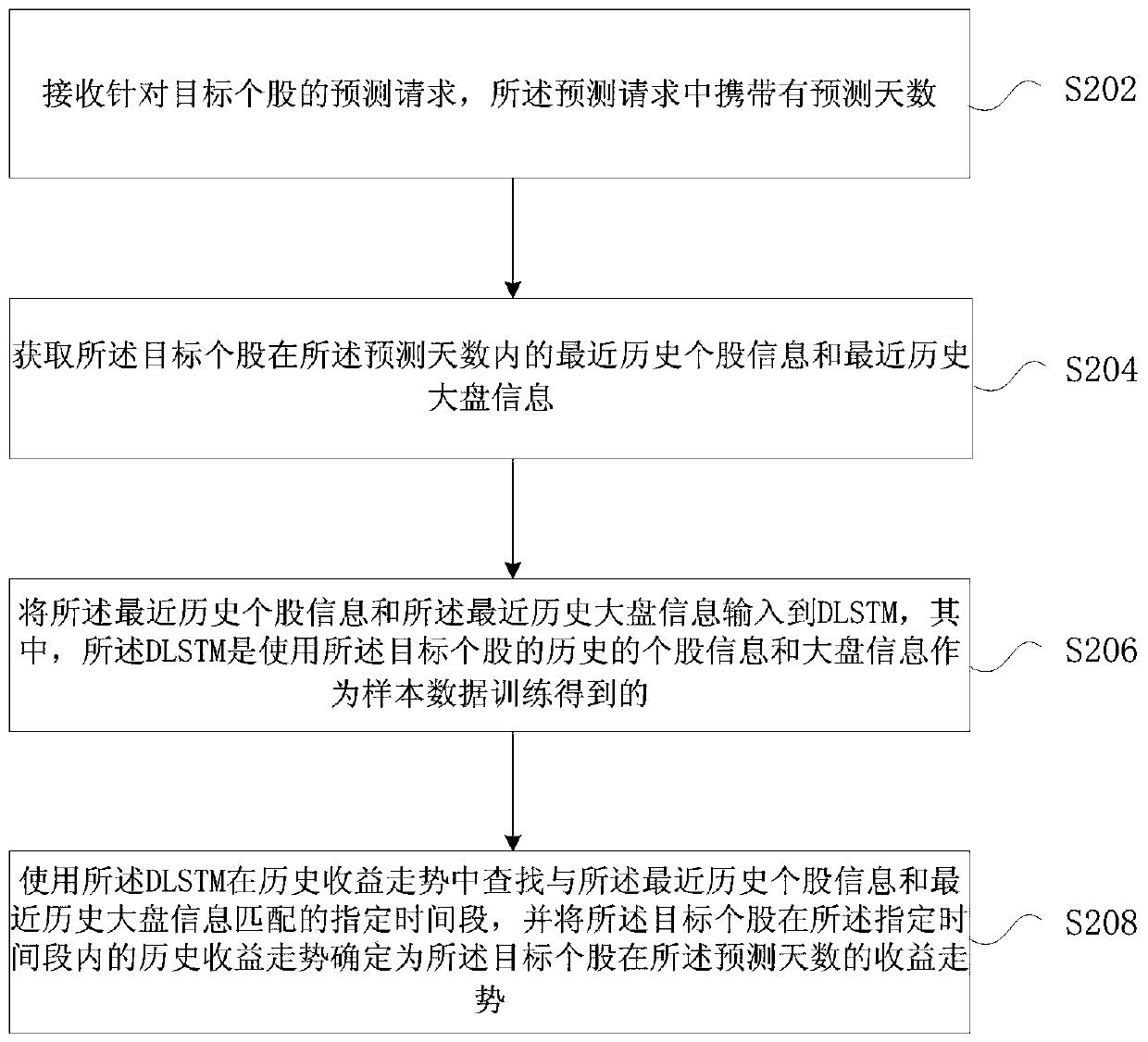

Stock prediction method and device, computer equipment and storage medium

The embodiment of the invention provides a stock prediction method and device, computer equipment and a storage medium. On one hand, the method comprises: receiving a prediction request for a target individual share, wherein the prediction request carries prediction days; obtaining recent historical individual stock information and recent historical large stock information of the target individualstock within the prediction days; inputting the recent historical individual stock information and the recent historical big stock information into a differential long and short memory time sequencemodel DLSTM, the DLSTM being obtained by training by using the historical individual stock information and the big stock information of the target individual stock as sample data; using the DLSTM to search a specified time period matched with the latest historical individual stock information and the latest historical stock market information in the historical revenue trend, and determining the historical revenue trend of the target individual stock in the specified time period as the revenue trend of the target individual stock in the prediction days. According to the method and the device, the technical problems of over-high requirements on personnel and low accuracy in stock prediction by adopting factor stock selection in the prior art are solved.

Owner:PING AN TECH (SHENZHEN) CO LTD

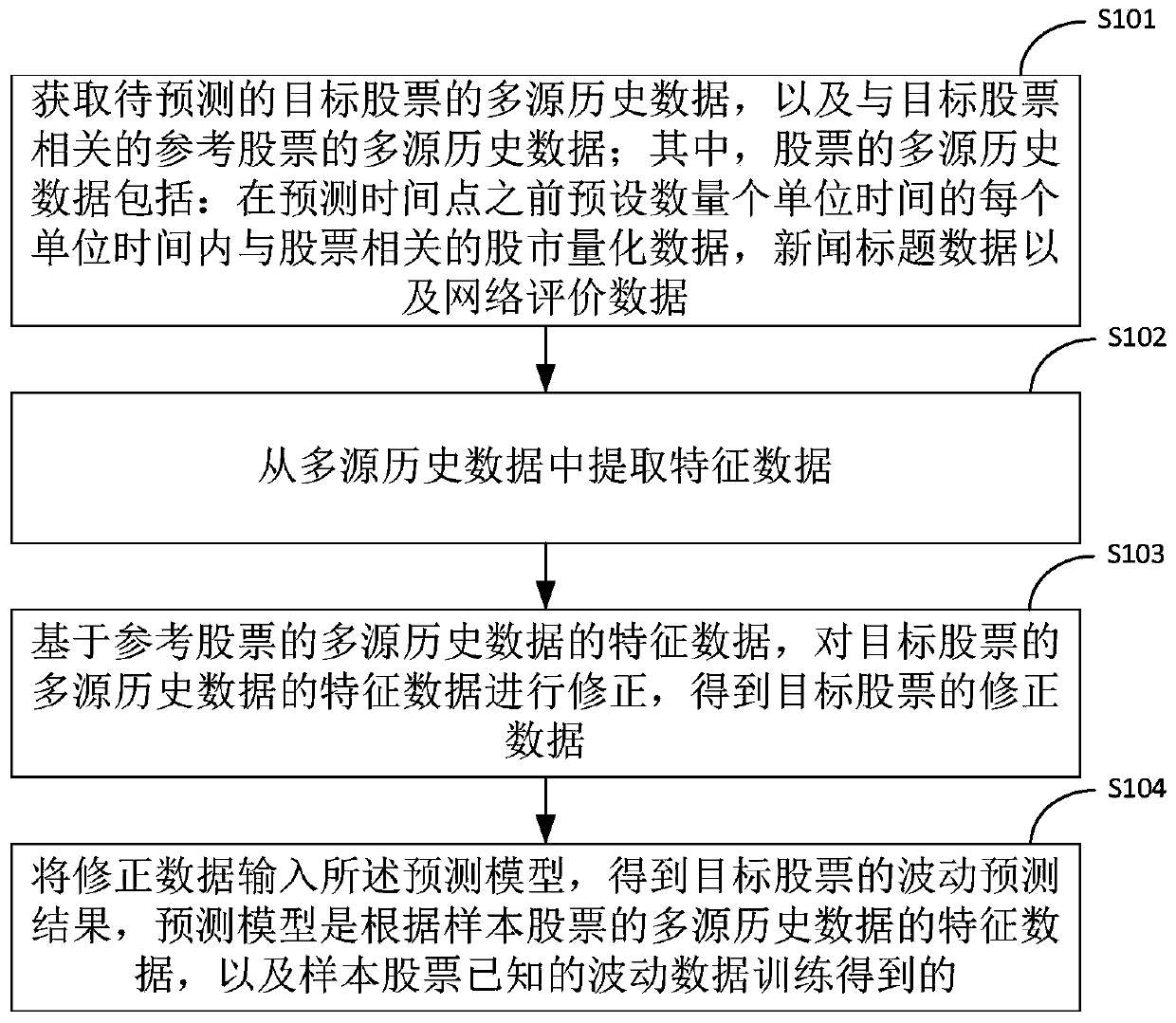

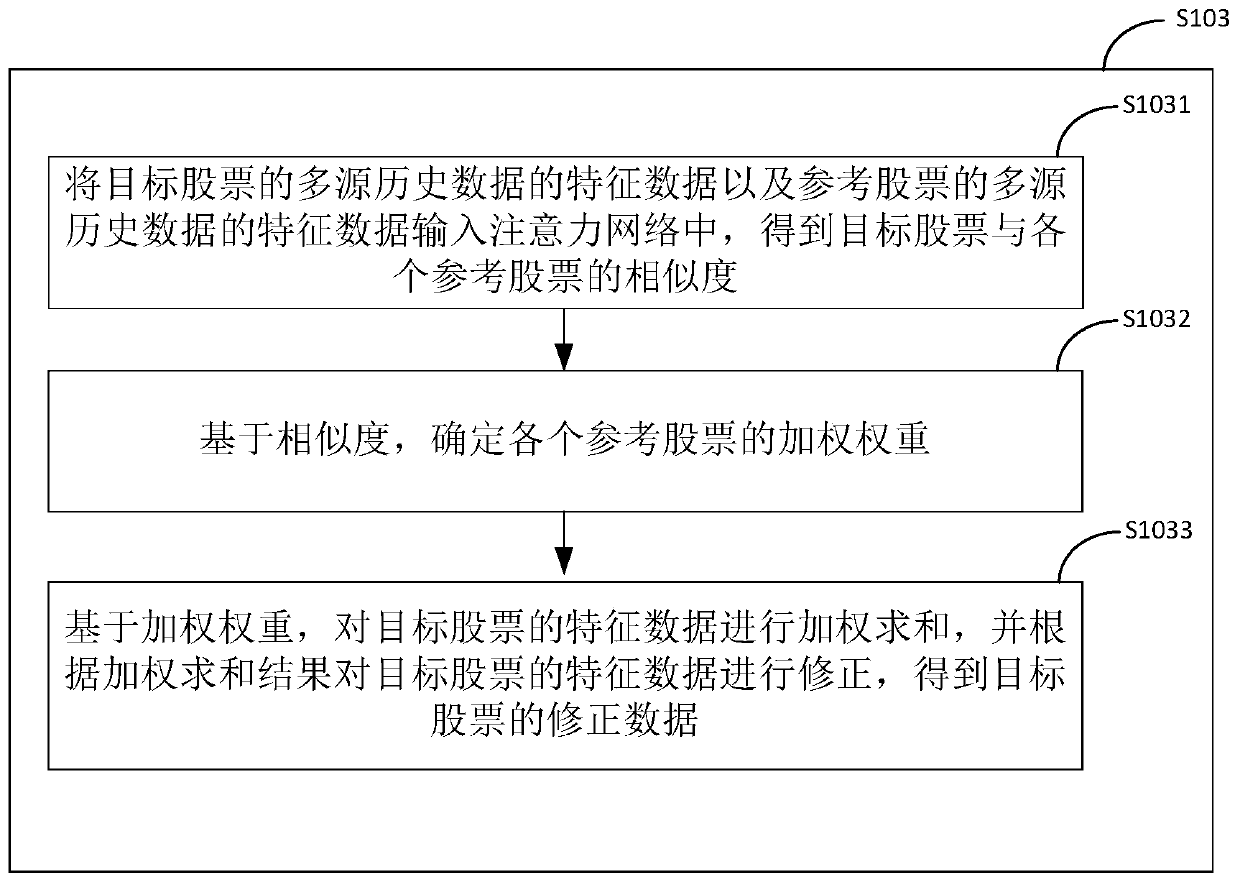

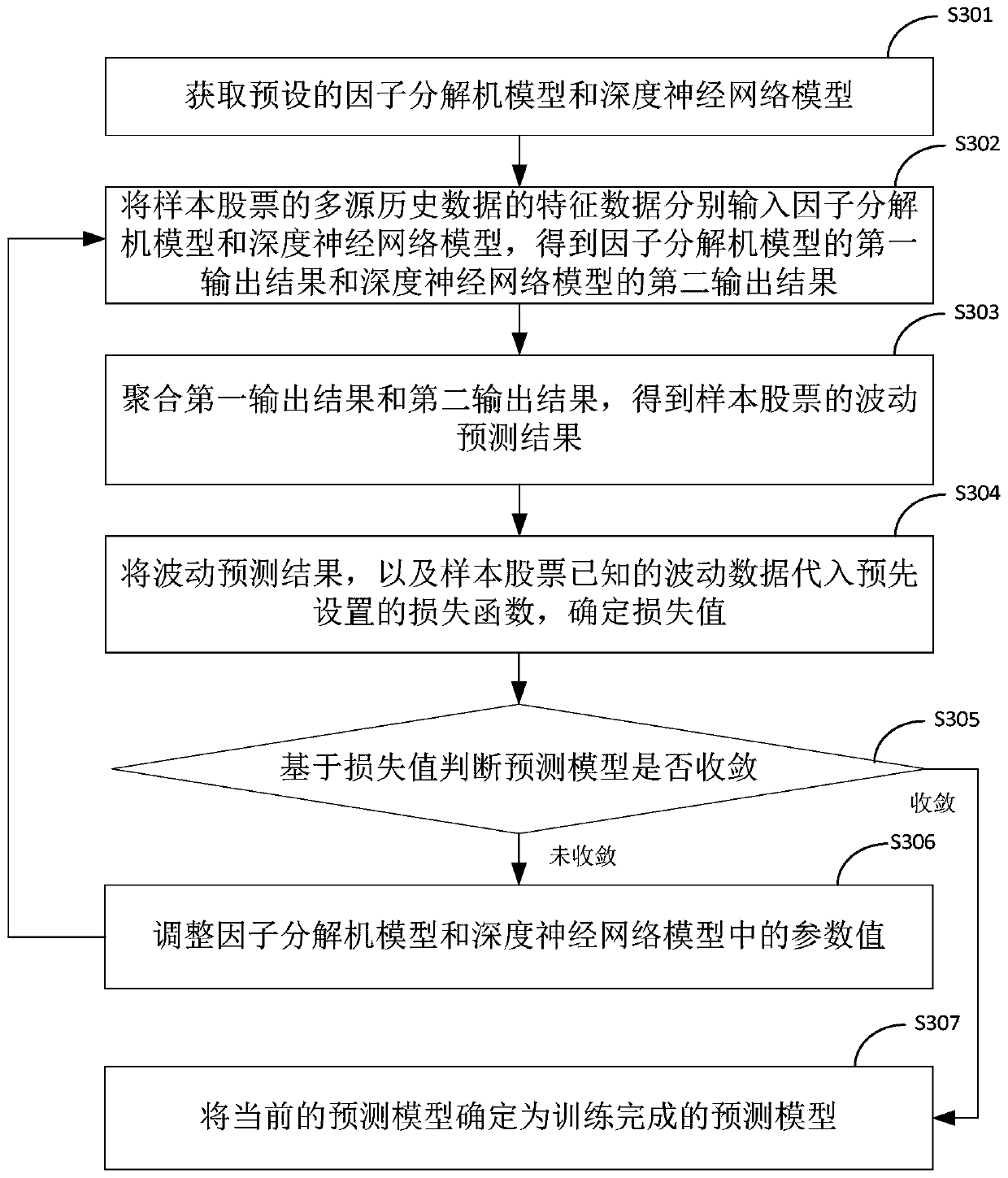

Stock fluctuation prediction method and device

ActiveCN111178498AVolatility prediction results improvedAccurate captureFinanceForecastingData packData source

Embodiments of the invention provide a stock prediction method and apparatus. The method comprises the steps of obtaining multi-source historical data of a to-be-predicted target stock and multi-source historical data of a reference stock related to the target stock, wherein the multi-source historical data of the stock comprises stock market quantitative data, news title data and network evaluation data related to the stock in each unit time of a preset number of unit time before the prediction time point; extracting feature data from the multi-source historical data; correcting the feature data of the multi-source historical data of the target stock based on the feature data of the multi-source historical data of the reference stock to obtain corrected data of the target stock; and inputting the correction data into the prediction model to obtain a fluctuation prediction result of the target stock. Historical data, including stock market quantitative data, news title data and networkevaluation data, of multiple data sources are comprehensively considered, and the trend of stock fluctuation can be captured more accurately.

Owner:BEIJING UNIV OF POSTS & TELECOMM

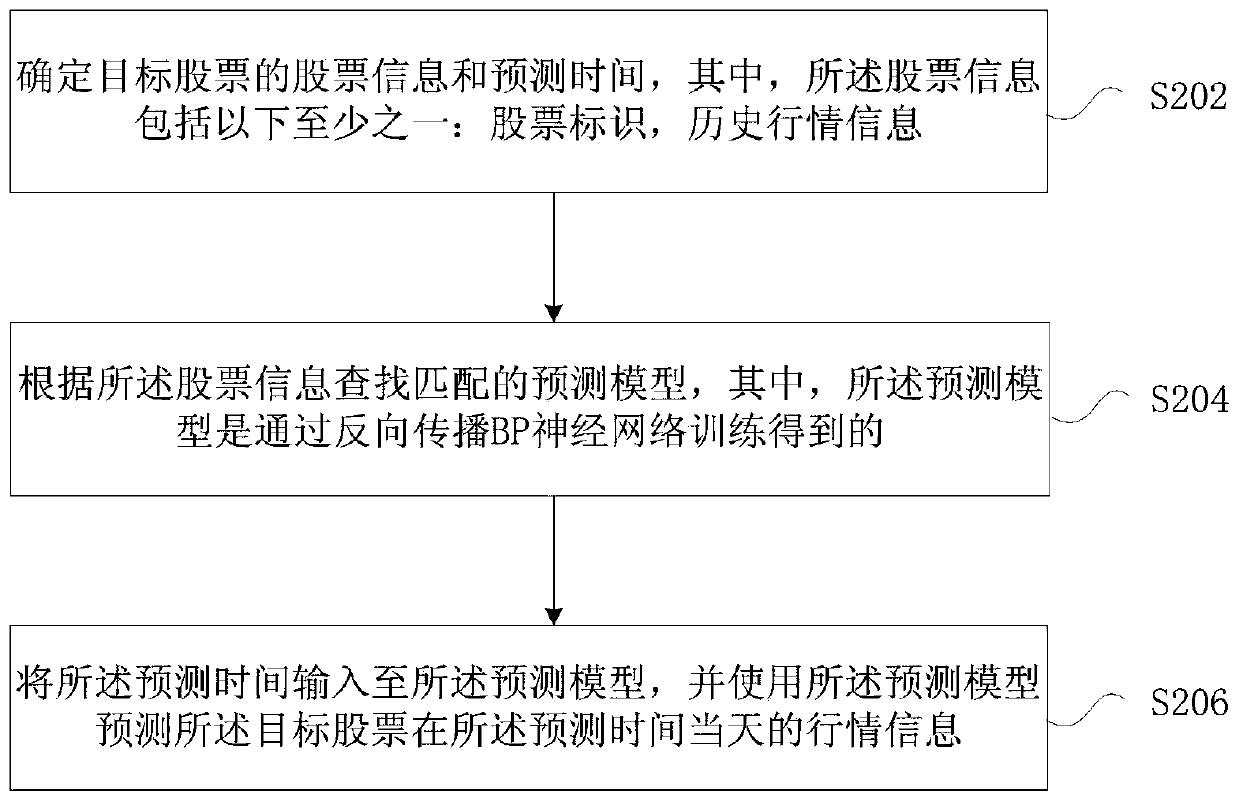

Stock prediction method and device, computer equipment and storage medium

PendingCN110378512ASolve technical problems with low accuracyImprove accuracyFinanceForecastingData miningComputer equipment

The embodiment of the invention provides a stock prediction method and a device, computer equipment and a storage medium. On one hand, the method comprises the steps of determining stock information and prediction time of a target stock, and the stock information comprises at least one of a stock identifier and historical market information; searching a matched prediction model according to the stock information, the prediction model being obtained by training a back propagation BP neural network; and inputting the prediction time into the prediction model, and predicting market information ofthe target stock on the day of the prediction time by using the prediction model. According to the method, the technical problem of low stock prediction accuracy in the prior art is solved.

Owner:PING AN TECH (SHENZHEN) CO LTD

Stock prediction method based on optimized historical data back testing policy

InactiveCN106157143AOptimization parametersAccurate predictionFinanceForecastingData miningTime data

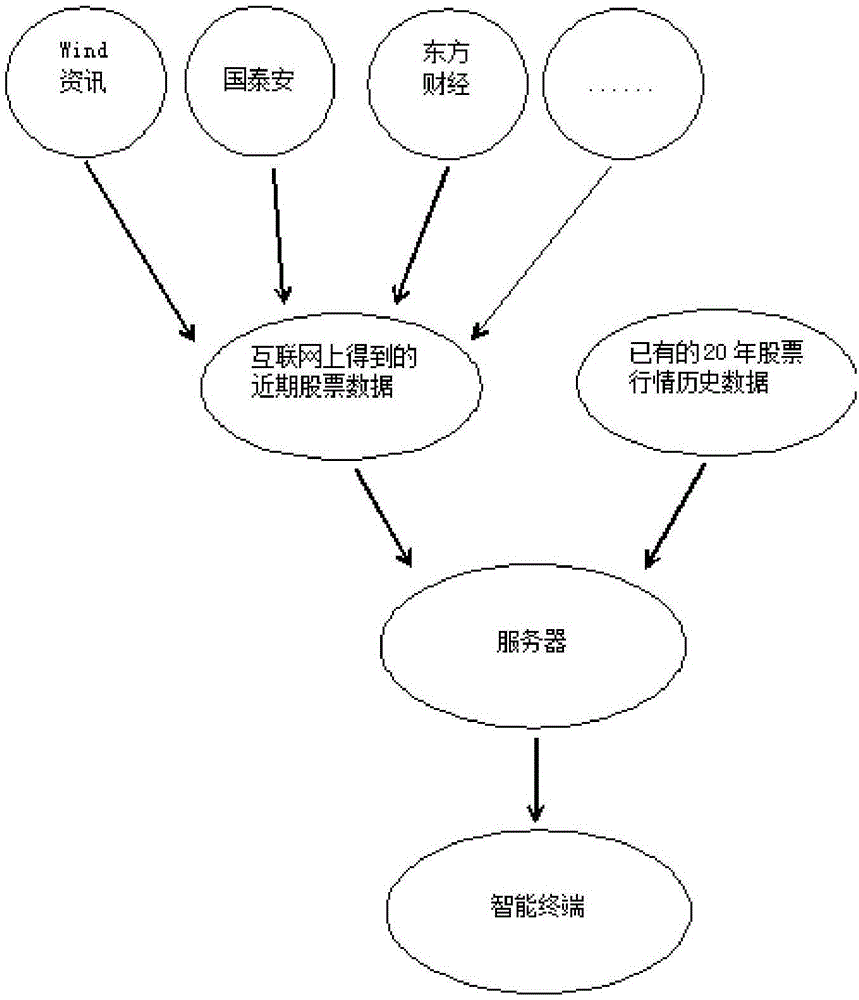

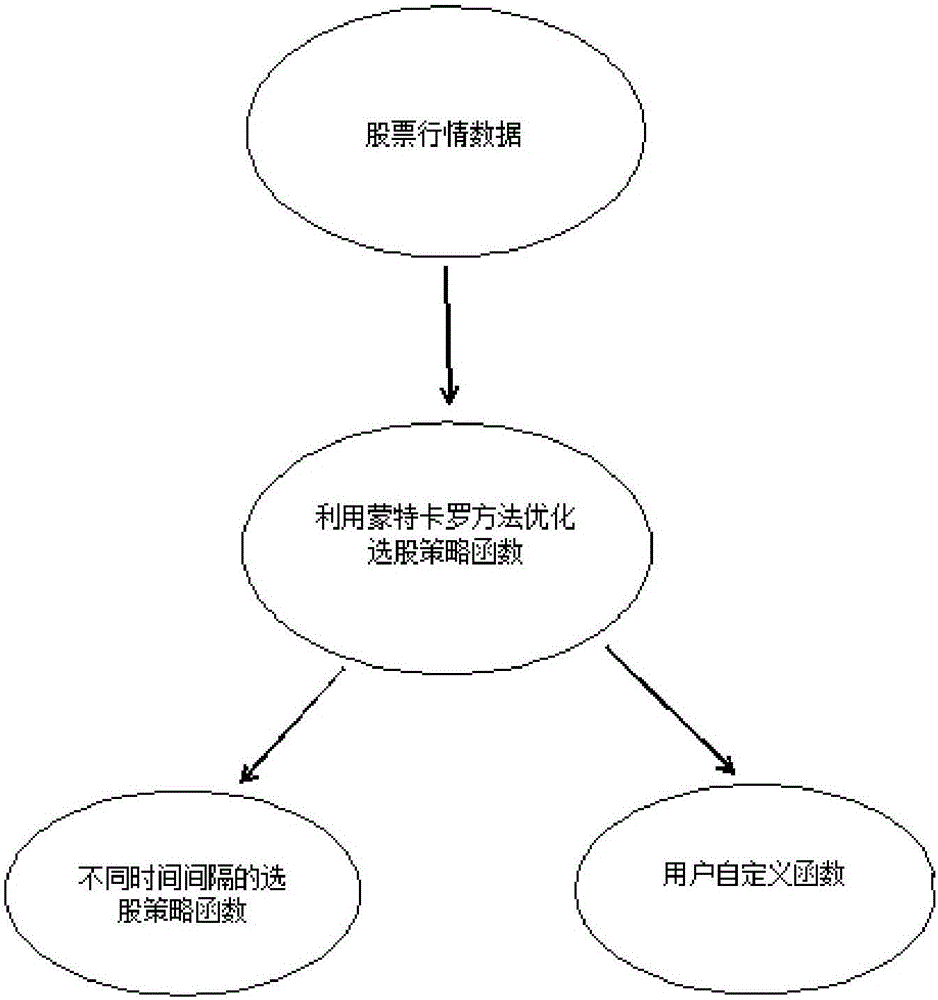

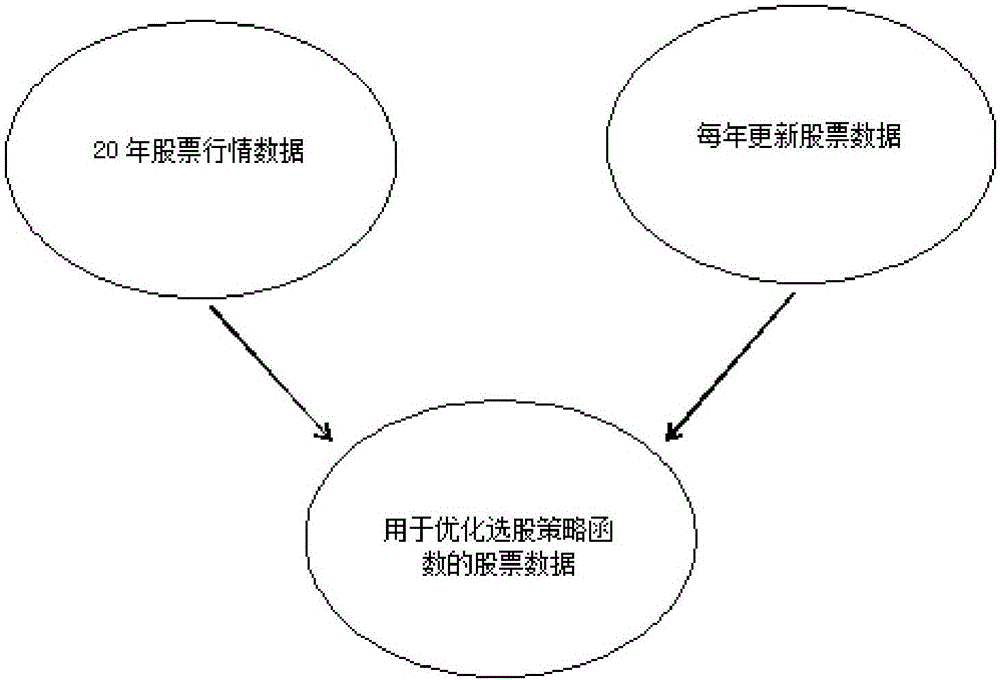

The invention discloses a stock prediction method based on an optimized historical data back testing policy. The stock quotation data of 20 years since 1990s and the recent stock quotation data from data suppliers at a time interval are calculated on a server, and a stock selection policy function is obtained by using a Monte Carlo method while the probability of the buying / selling point is estimated; the probability is used as the predicated stock buying / selling point and the stock selection policy function is pushed to an intelligent terminal; and in the stock selection policy function, the investors can select the functions predicted by use of different time intervals. According to the invention, the stock historical data is subjected to back testing by the Monte Carlo method, the parameters of the stock selection policy function are optimized, and the stock buying / selling point can be predicted more accurately.

Owner:安徽磐众信息科技有限公司

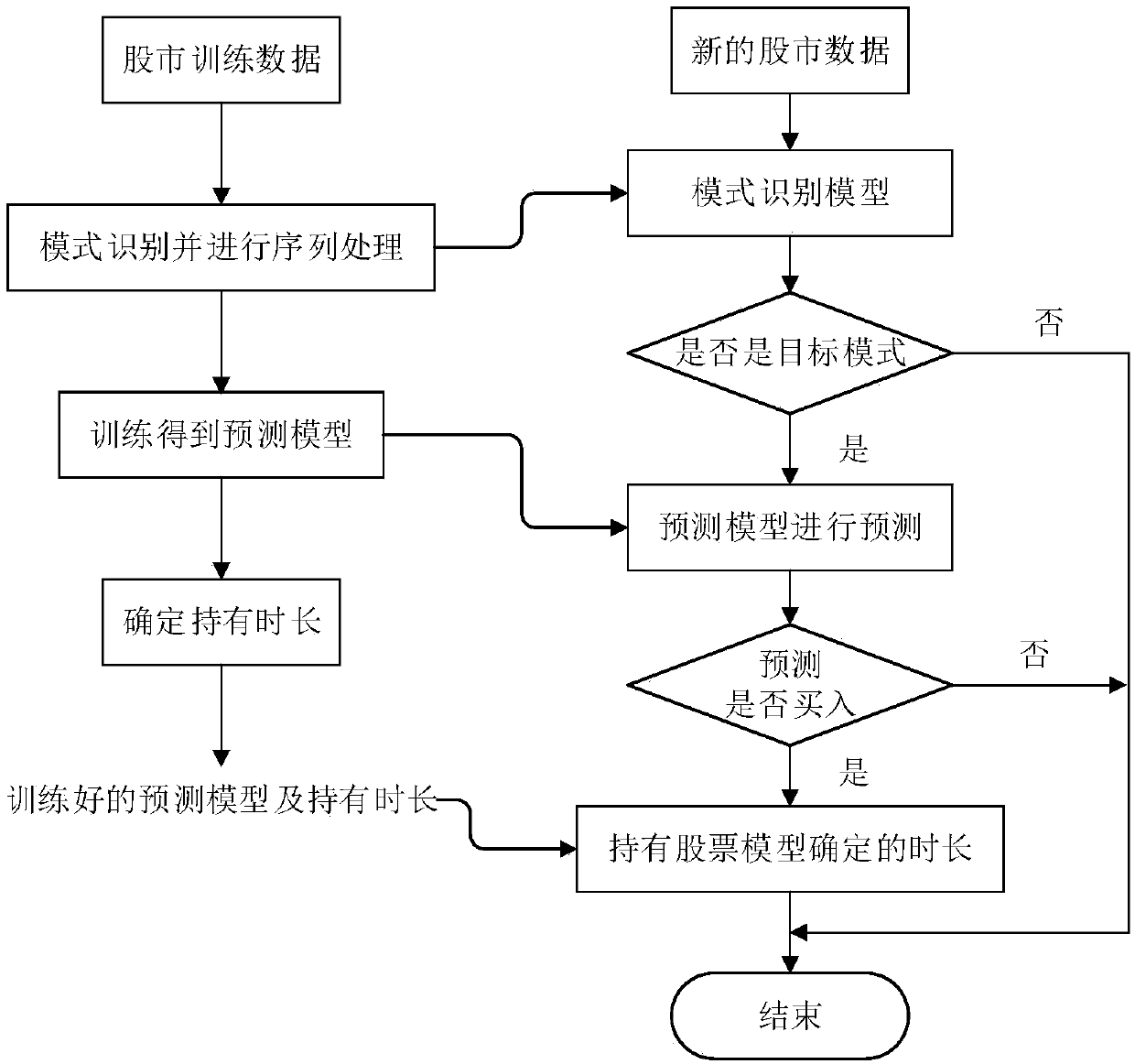

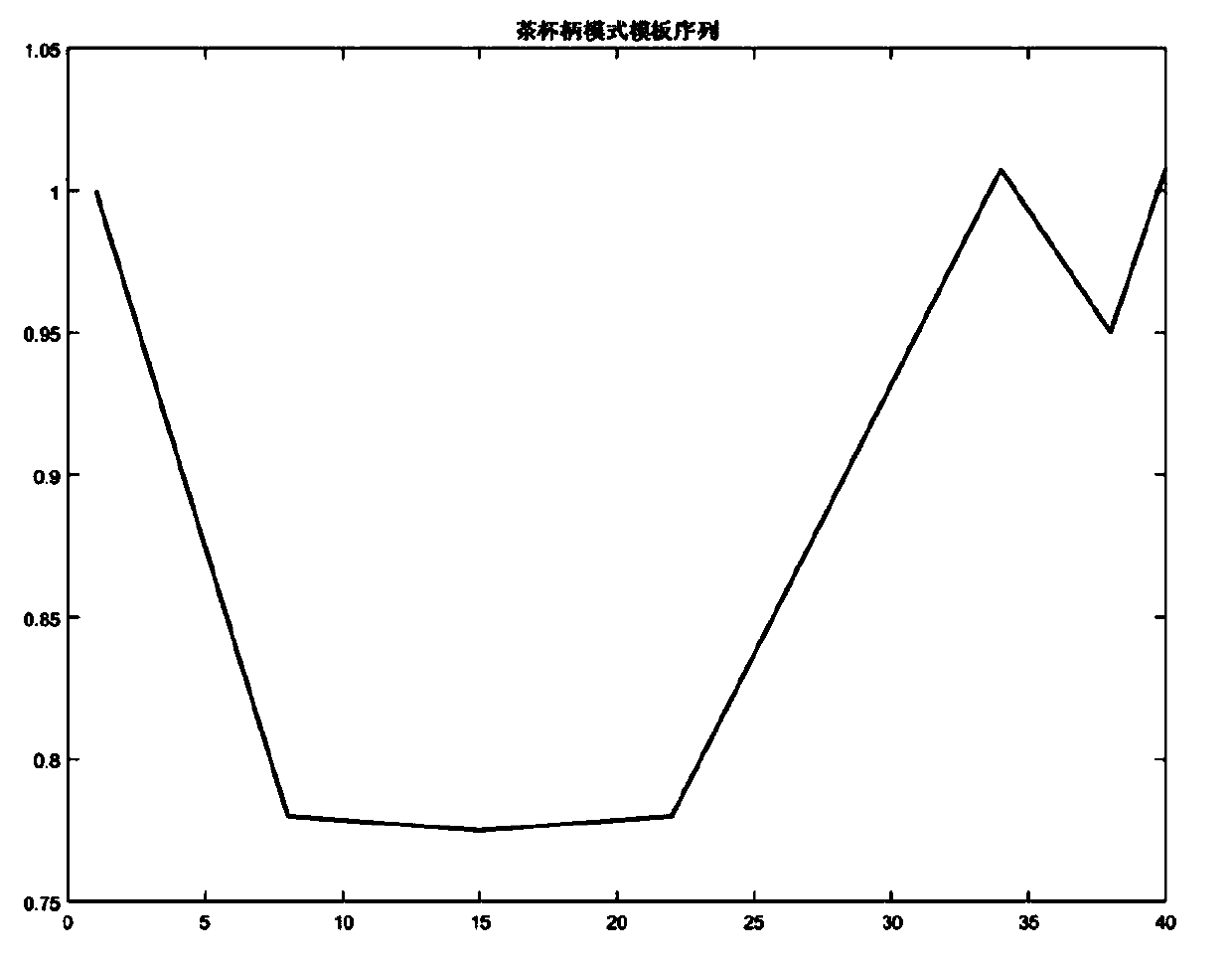

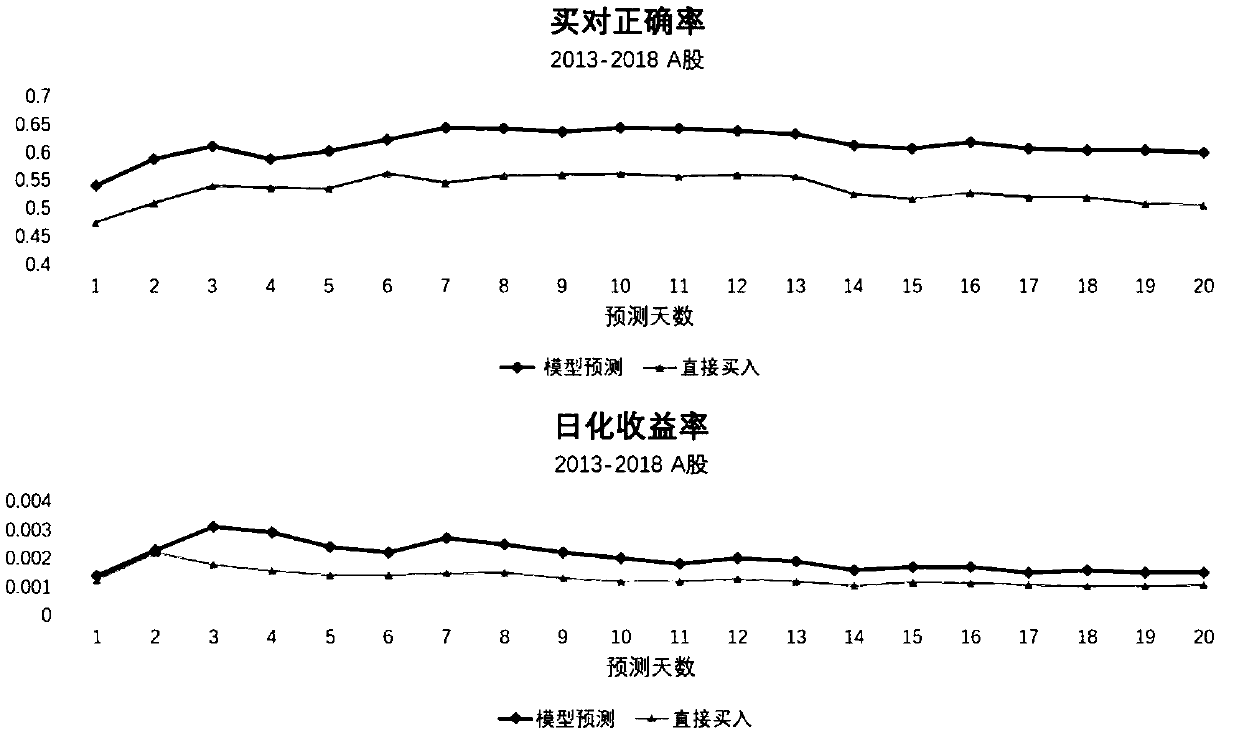

A stock mode automatic identification and prediction method

PendingCN109670966AReduce labor costsReduce the risk of buying the wrong oneFinanceForecastingSupport vector machineFeature extraction

The invention discloses a stock mode automatic identification and prediction method, which detects a graph mode which has occurred in stock market history through a mode identification method, uses the graph mode as training data for training of a support vector machine for stock prediction, and can automatically identify the graph mode and make a transaction decision. The method comprises the following steps of designing a stock market history chart pattern recognition method; carrying out the chart mode feature extraction; training of a vector machine and determination of stock holding timeare supported. The method mainly aims at reducing the problem that traditional manual work is high in cost in chart mode discovery and improving the accuracy rate of a traditional chart mode, the prediction result is more accurate than that of a traditional method, and excessive income can be obtained in a back test experiment.

Owner:ZHEJIANG UNIV

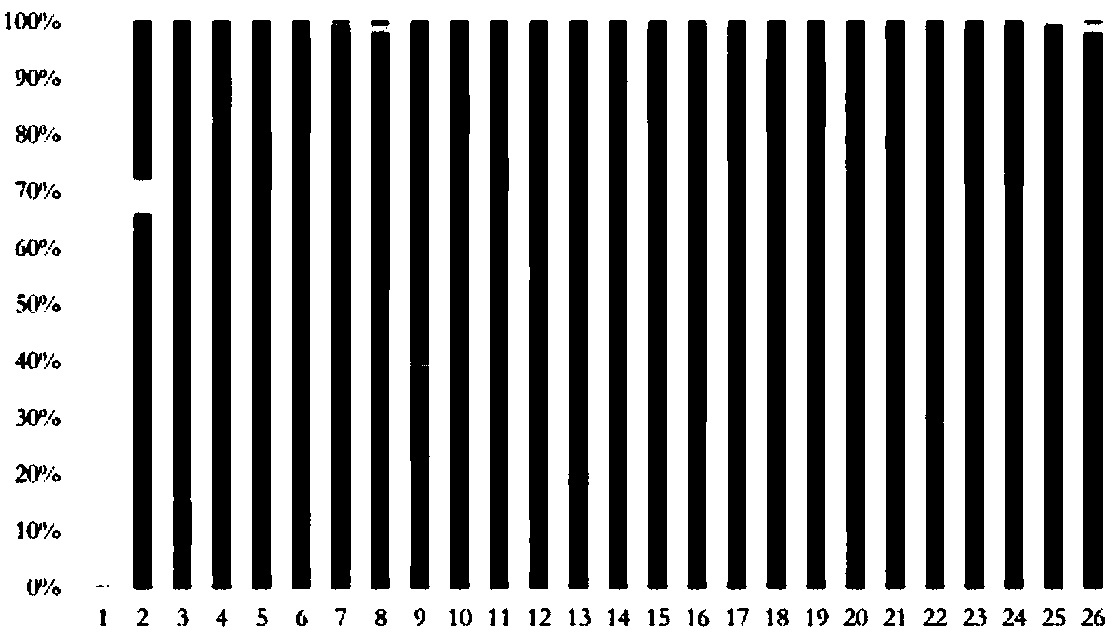

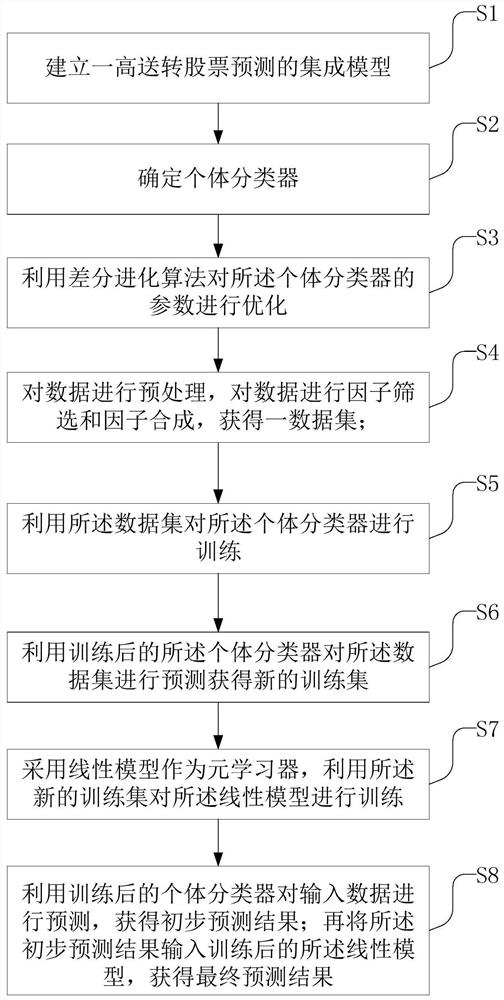

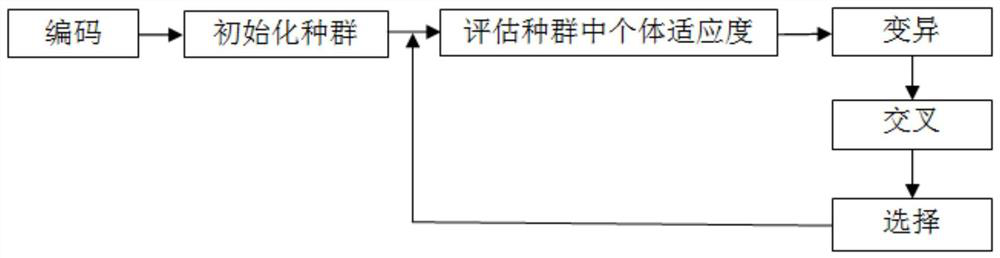

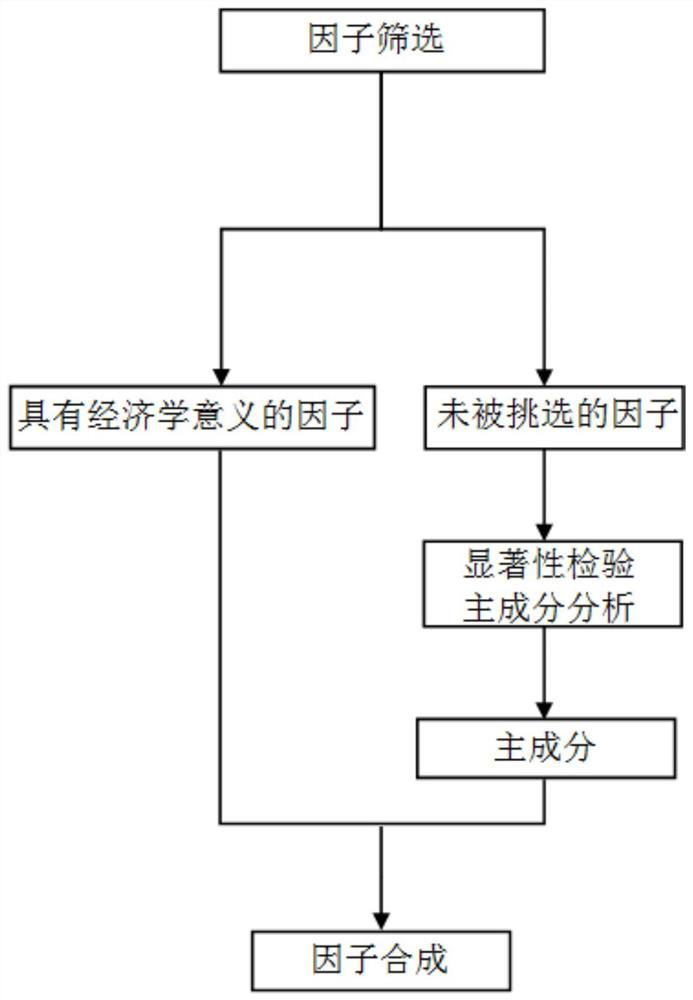

Stock prediction method of integrated model based on high-speed transfer stock prediction

The invention provides a stock prediction method based on an integrated model for high-speed transfer stock prediction. The method comprises the following steps: S1, establishing the integrated model for high-speed transfer stock prediction; s2, determining an individual classifier; s3, optimizing parameters of the individual classifier by using a differential evolution algorithm; s4, preprocessing the data, and performing factor screening and factor synthesis on the data; s5, training an individual classifier by using the data set; s6, predicting the data set by using the trained individual classifier; s7, using a linear model as a meta-learner, and training the linear model by using the new training set; s8, performing prediction by using the trained individual classifier to obtain a preliminary prediction result; and inputting the preliminary prediction result into the trained linear model to obtain a final prediction result. According to the stock prediction method of the integrated model based on high-speed transfer stock prediction, the integrated model is better trained, and the investment safety is further ensured.

Owner:SHANGHAI DIANJI UNIV

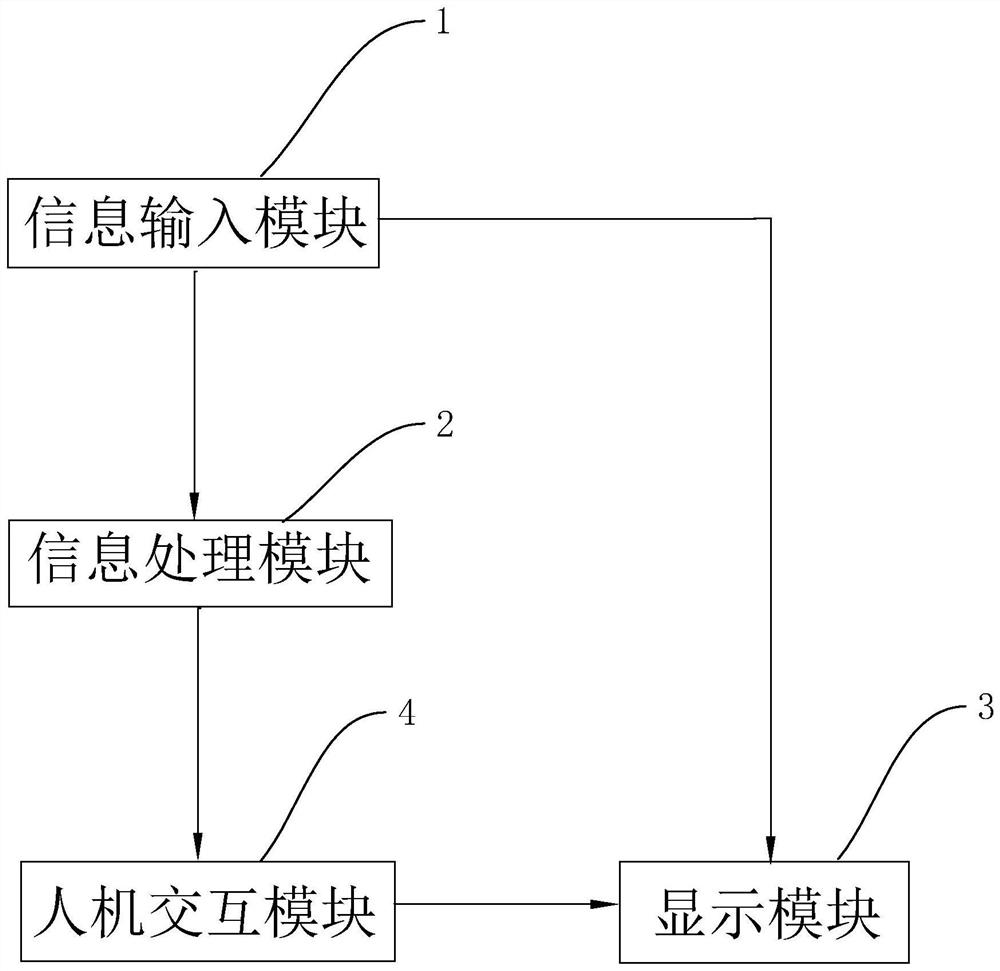

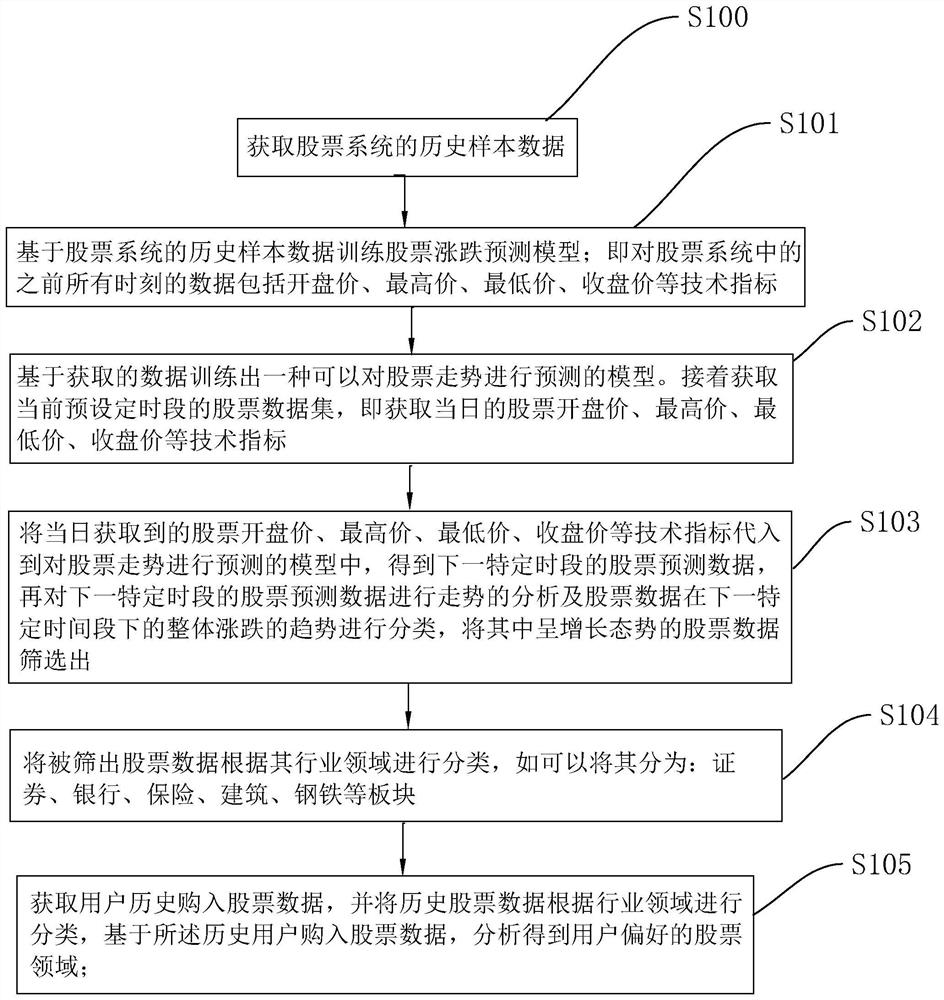

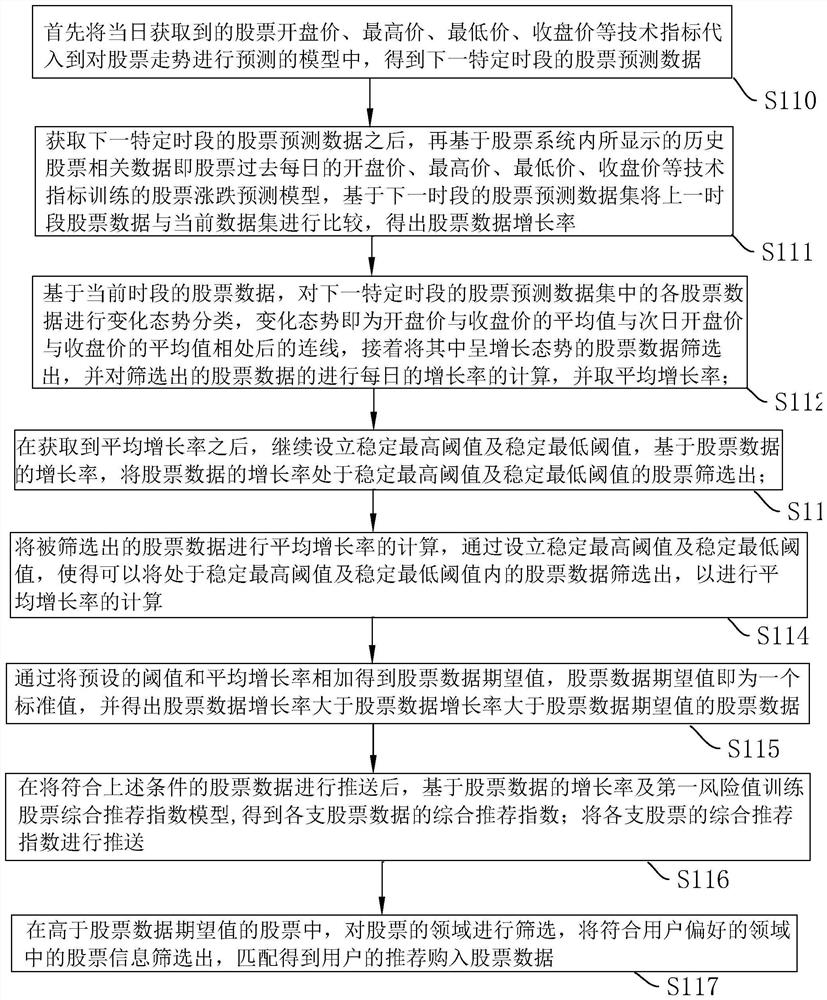

Artificial intelligence stock system application method

PendingCN114820191AIncrease the likelihood of benefitReduce the possibility of lossDigital data information retrievalFinanceData setDomain analysis

The invention relates to an artificial intelligence stock system application method, and relates to the technical field of stock transaction, and the method comprises the steps: training a rise and fall prediction model, predicting a stock prediction data set in a next period, screening growth situation stock data, classifying the stock data, analyzing a user preference field, and correspondingly pushing information. According to the artificial intelligence stock system, the stock in the corresponding field can be pushed to the user, so that the buyed stock can correspond to the field understood by the user, the user can better understand the stock data to judge holding or selling, and the possibility that the user benefits is increased.

Owner:中科柏诚科技(北京)股份有限公司

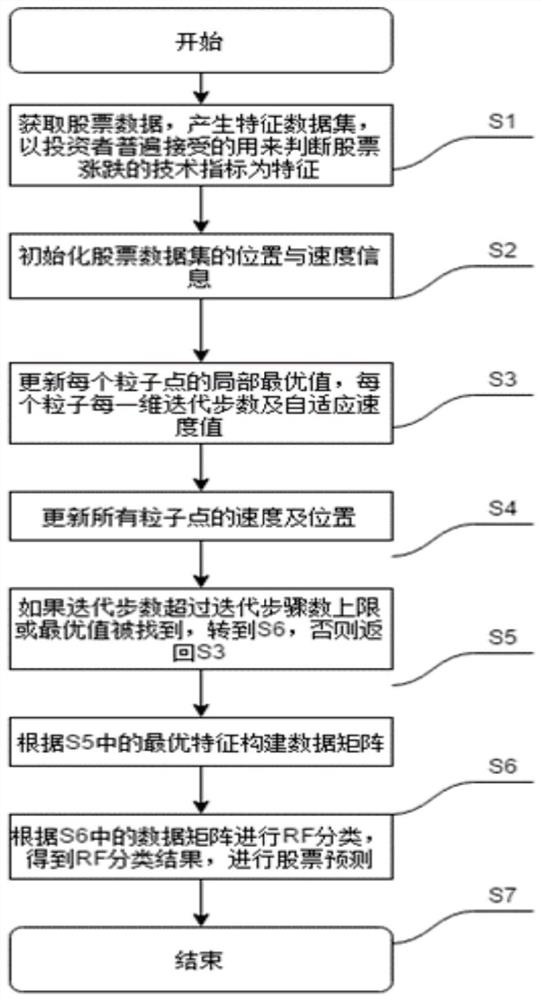

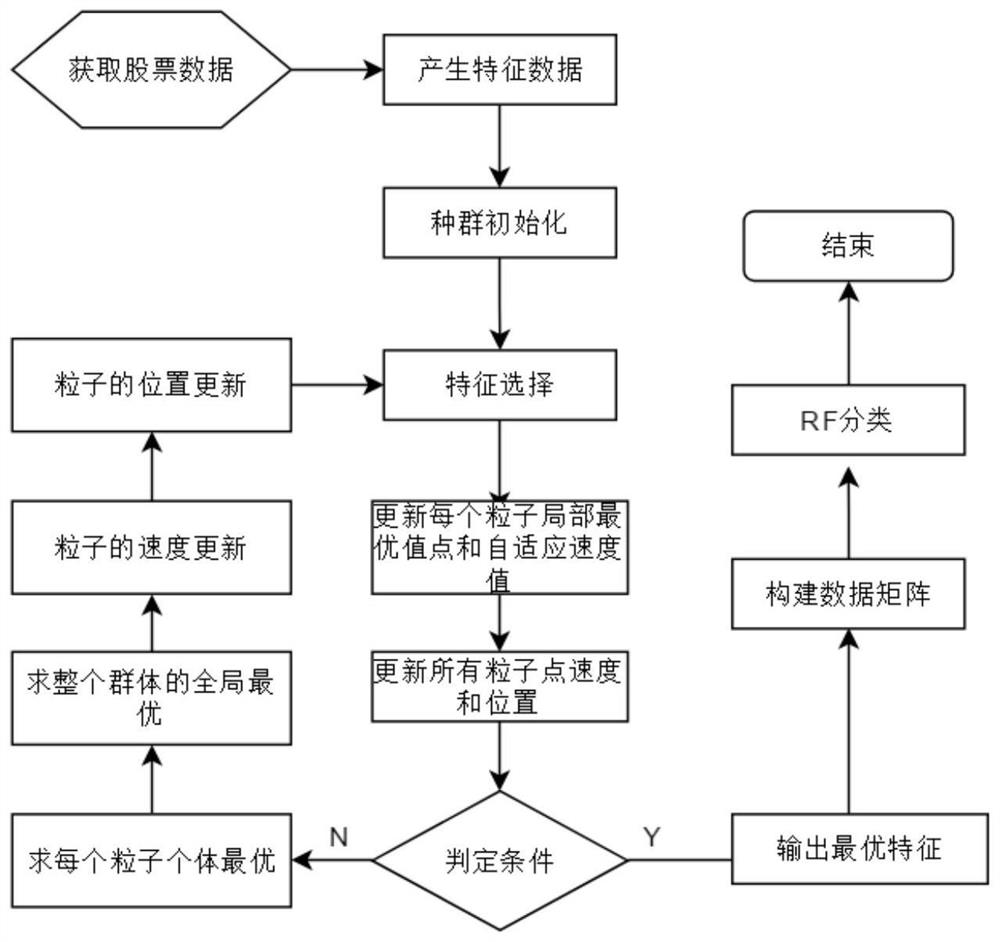

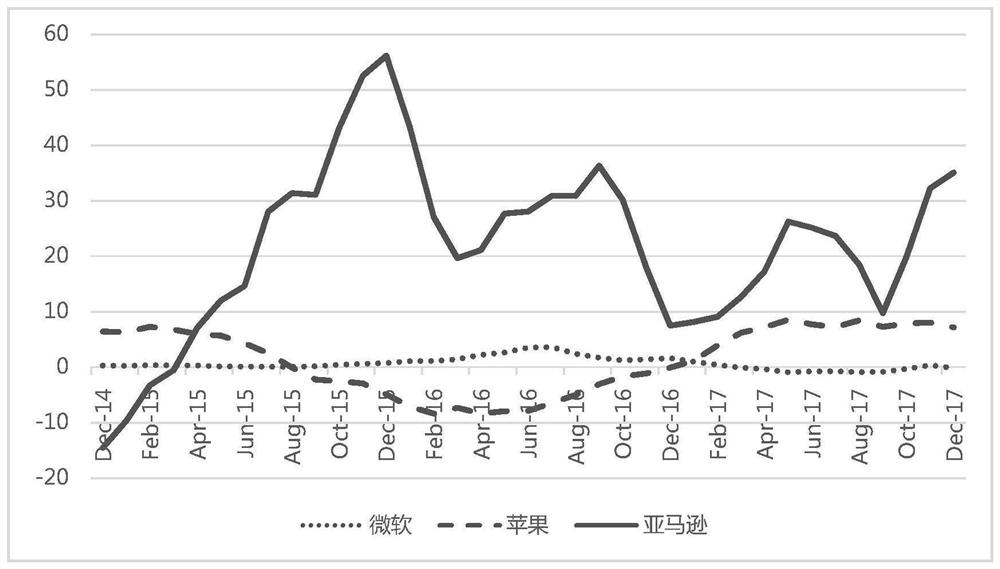

Method of analyzing stock trends

The invention discloses a method for analyzing a stock trend. The method comprises steps of obtaining stock data through the method, and forming a feature data set; secondly, initializing the speed and position information of the stock data set, updating a local optimal value point of each particle point and the iteration step number and the self-adaptive speed value of each particle in each dimension, updating the speeds and positions of all the particle points, and finding a global optimal value point of the population from historical local optimal value points of all the particles; and finally, constructing a data matrix according to the optimal features, performing RF classification on the data matrix to obtain a classification result, performing stock prediction, and comparing the prediction result accuracy with a BPSO-RF algorithm. According to the method, the optimized discrete binary particle swarm is utilized to improve the random forest algorithm, remove redundant features, screen optimal features and input the optimal features into the RF algorithm for stock prediction, so the prediction precision is improved, the method provided by the invention has a high convergence rate, can find a better optimal value of the target function in the same iteration step, and reduces the stock prediction time.

Owner:SHANGHAI MARITIME UNIVERSITY

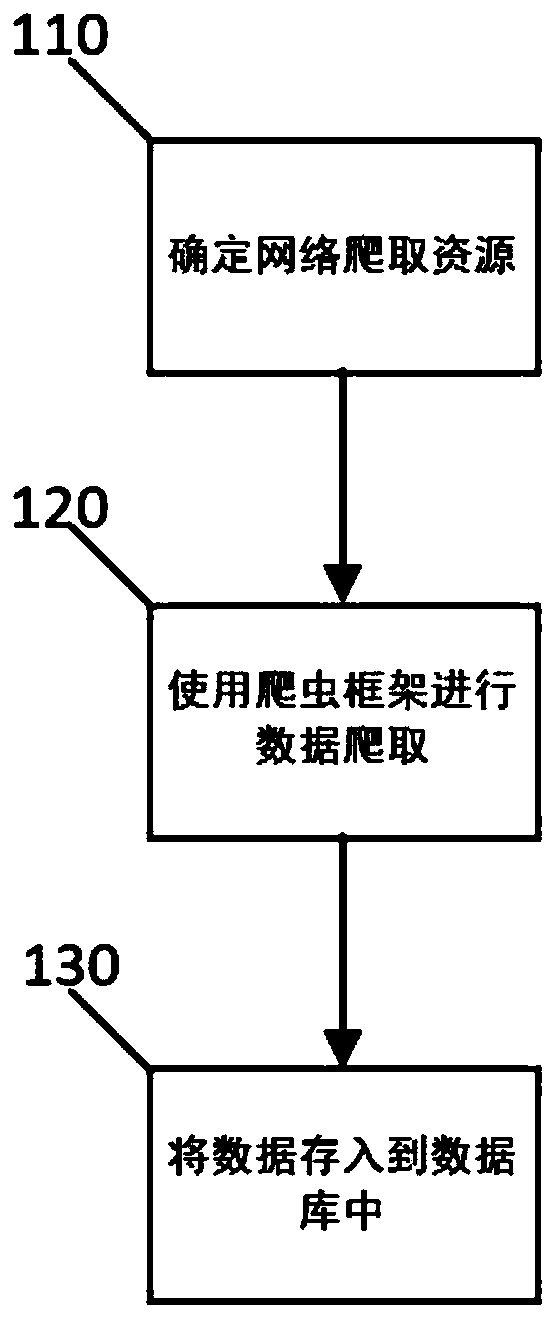

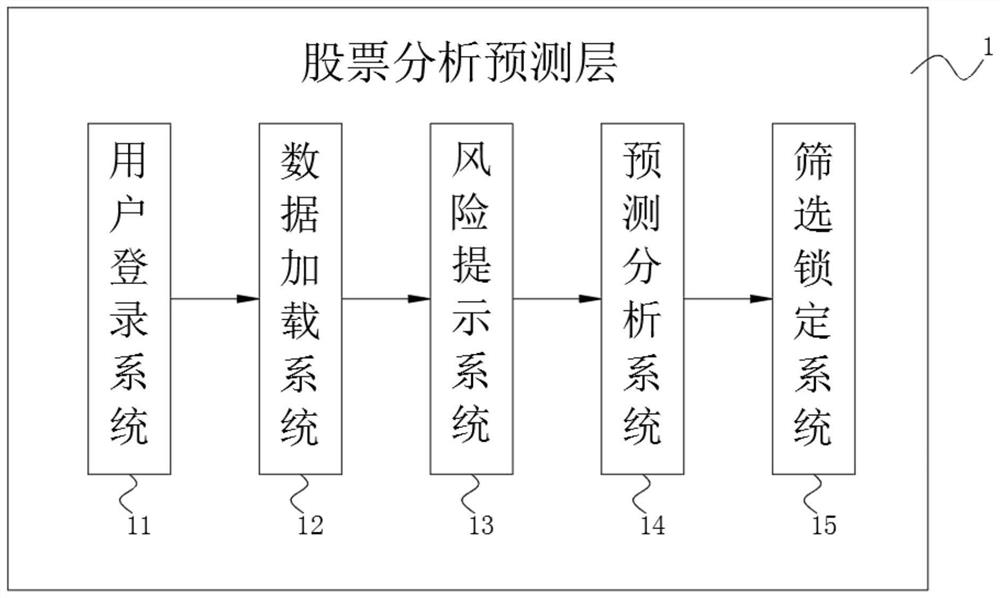

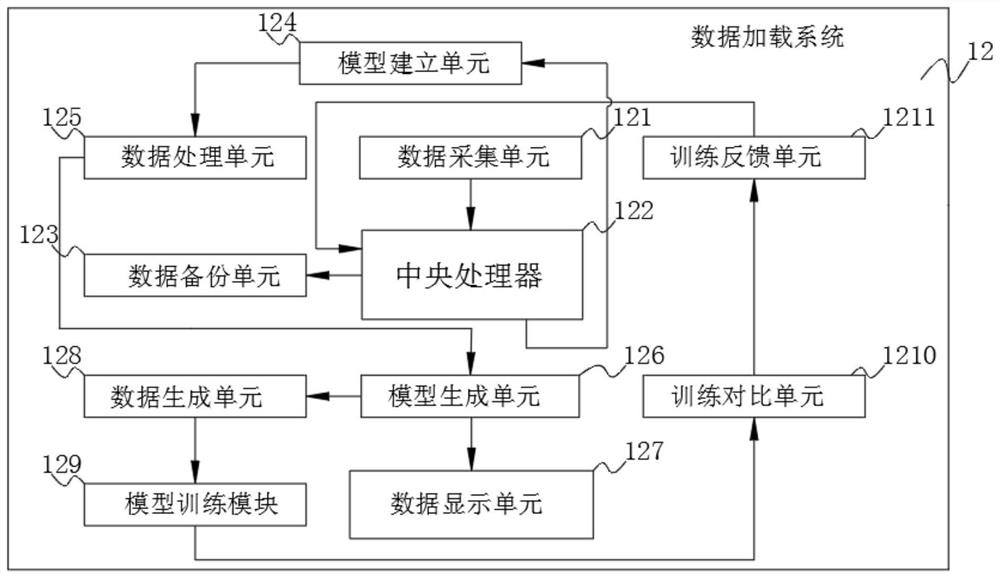

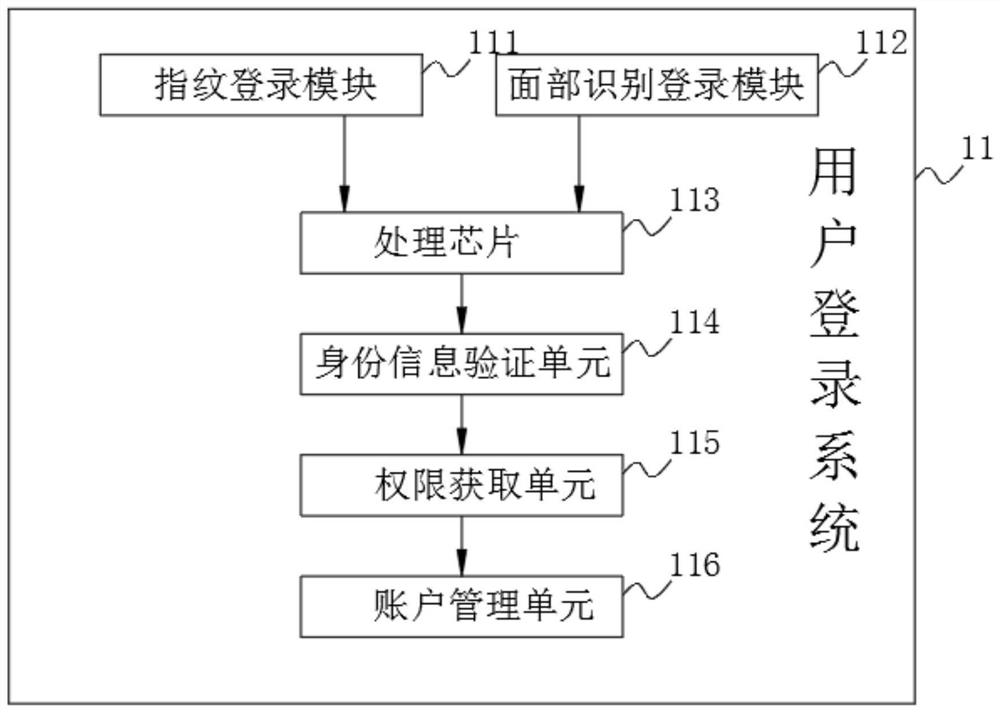

Stock prediction system based on data analysis

PendingCN114444874ATimely loadingPredictive analytics made easierFinanceResourcesData miningPredictive analytics

The invention discloses a stock prediction system based on data analysis, which comprises a stock analysis and prediction layer, the stock analysis and prediction layer comprises a user login system, a data loading system, a risk prompting system, a prediction and analysis system and a screening and locking system, and the output end of the user login system is connected with the input end of the data loading system. The output end of the data loading system is connected with the input end of the risk prompting system, the output end of the risk prompting system is connected with the input end of the prediction analysis system, and the output end of the prediction analysis system is connected with the input end of the screening locking system. According to the stock prediction system based on data analysis, through the arrangement of the data loading system and the screening locking system, various data can be conveniently loaded in time, so that the prediction analysis difficulty is reduced, the functions are relatively perfect, the data are updated in real time, comparison and screening can be intuitively performed, and the investment risk is reduced.

Owner:灯塔财经信息有限公司

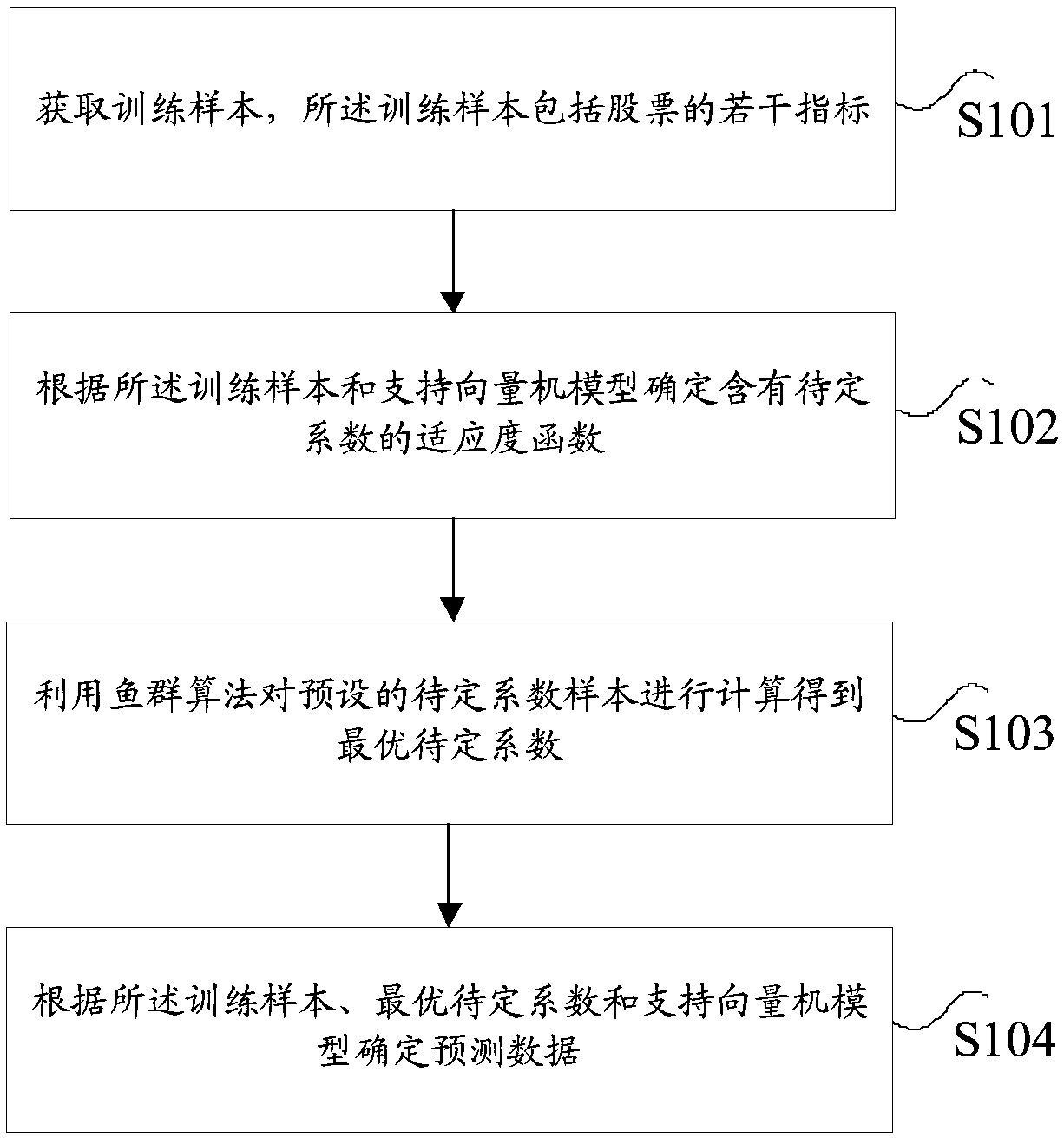

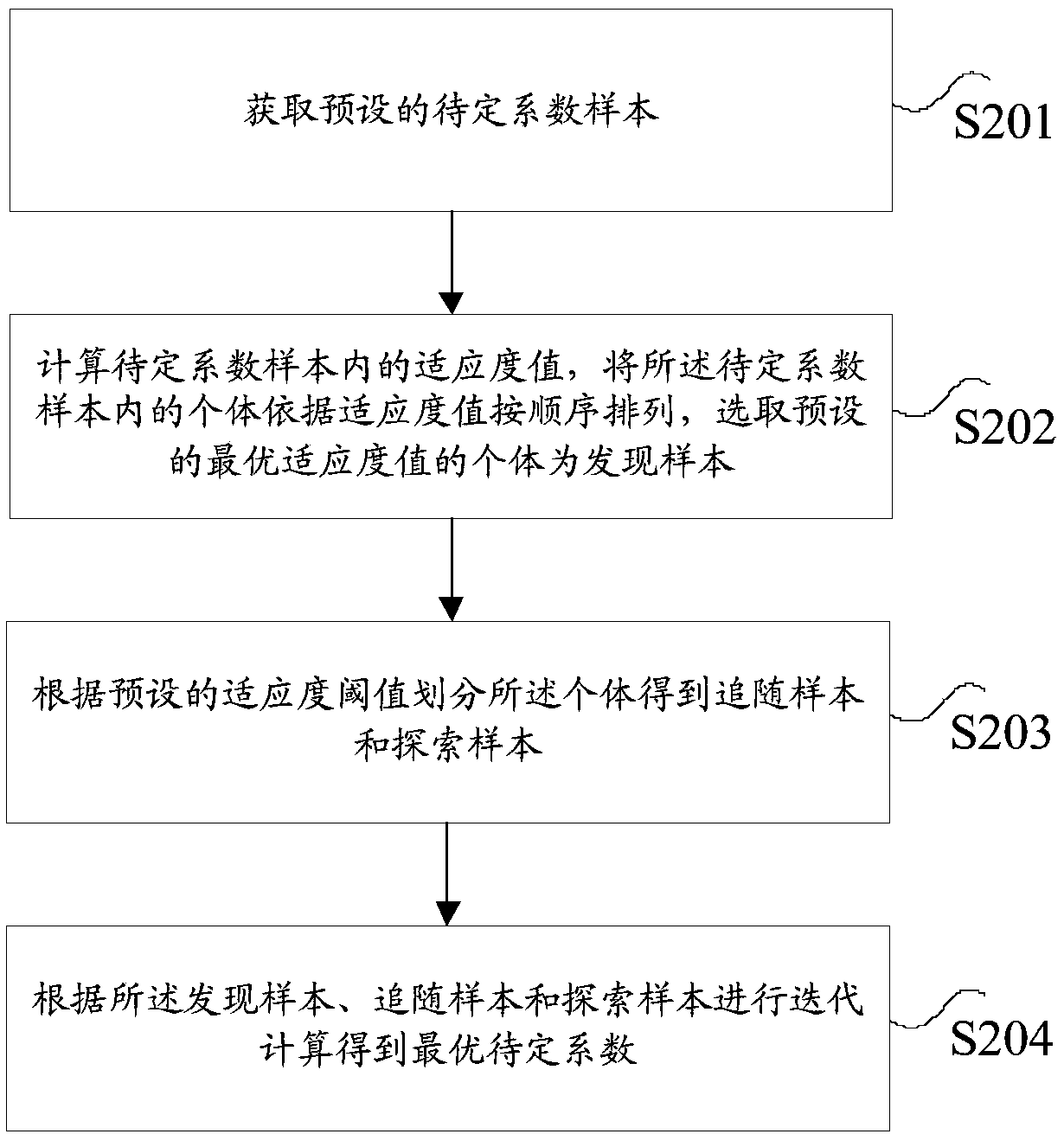

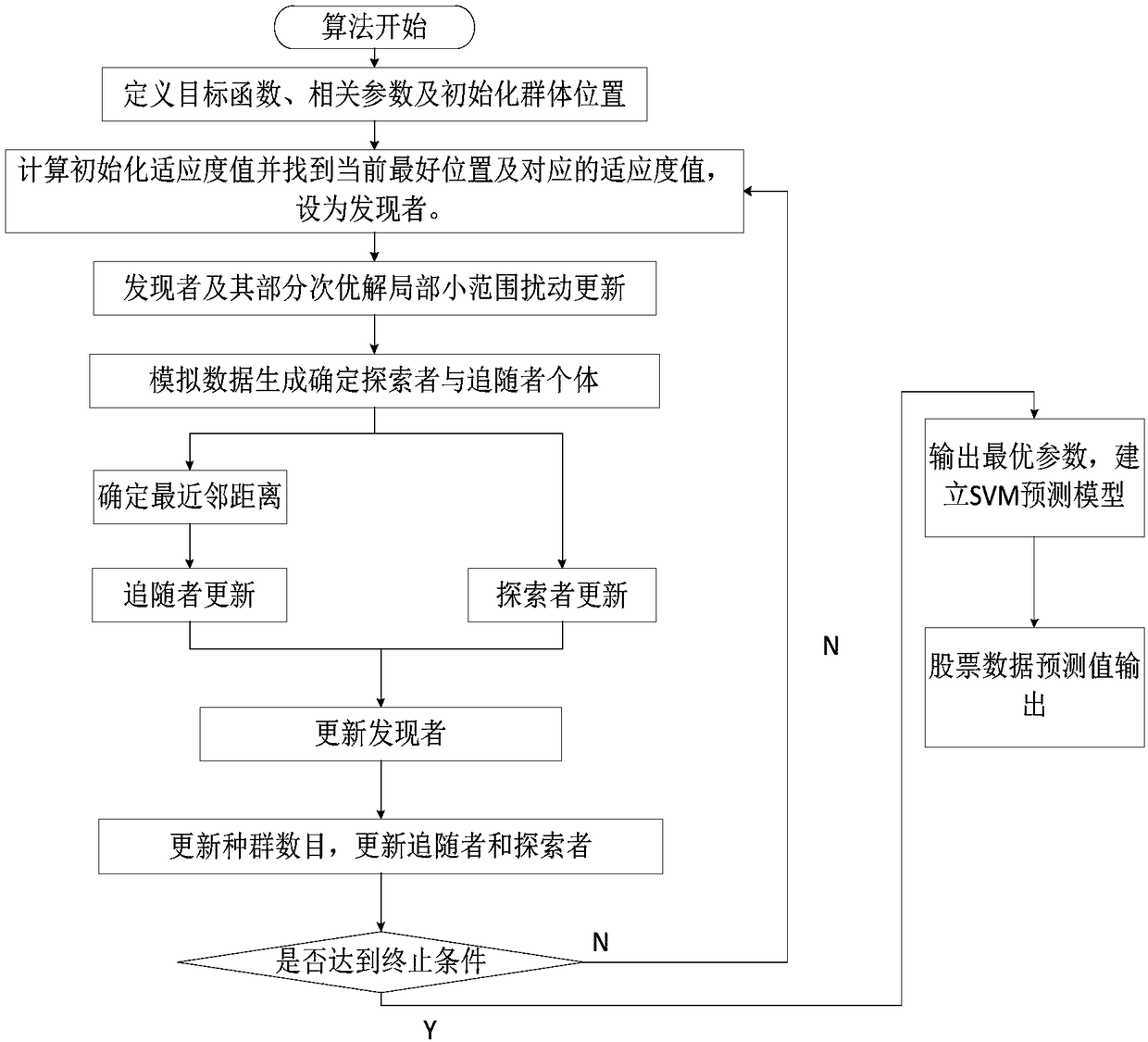

Stock prediction method and device

InactiveCN109345393AImprove accuracyAvoid uncertaintyFinanceKernel methodsSupport vector machineAlgorithm

The invention provides a stock prediction method and a device, which relate to the technical field of stock historical data prediction. Determining a fitness function containing undetermined coefficients according to the training sample and the support vector machine model; taking The fish swarm algorithm to compute the preset undetermined coefficient samples to obtain the optimal undetermined coefficient. In accordance with that train sample, the optimal waiting coefficients and the support vector machine model determine the way to predict the data, The undetermined coefficients of the support vector machine model are updated by fish swarm algorithm to avoid the uncertainty of artificial setting parameters, so that even if the amount of data is large, the support vector machine model canbe updated in real-time by the way of update iteration, which is not only suitable for changeable scenes, but also can achieve the technical effect of improving the accuracy of prediction results.

Owner:CHENGDU SEFON SOFTWARE CO LTD

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com