Stock prediction method based on optimized historical data back testing policy

A technology of historical data and forecasting methods, applied in forecasting, data processing applications, complex mathematical operations, etc., can solve problems such as no strong data support, no optimization, roughness, etc., to achieve scientific and real-time effects

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

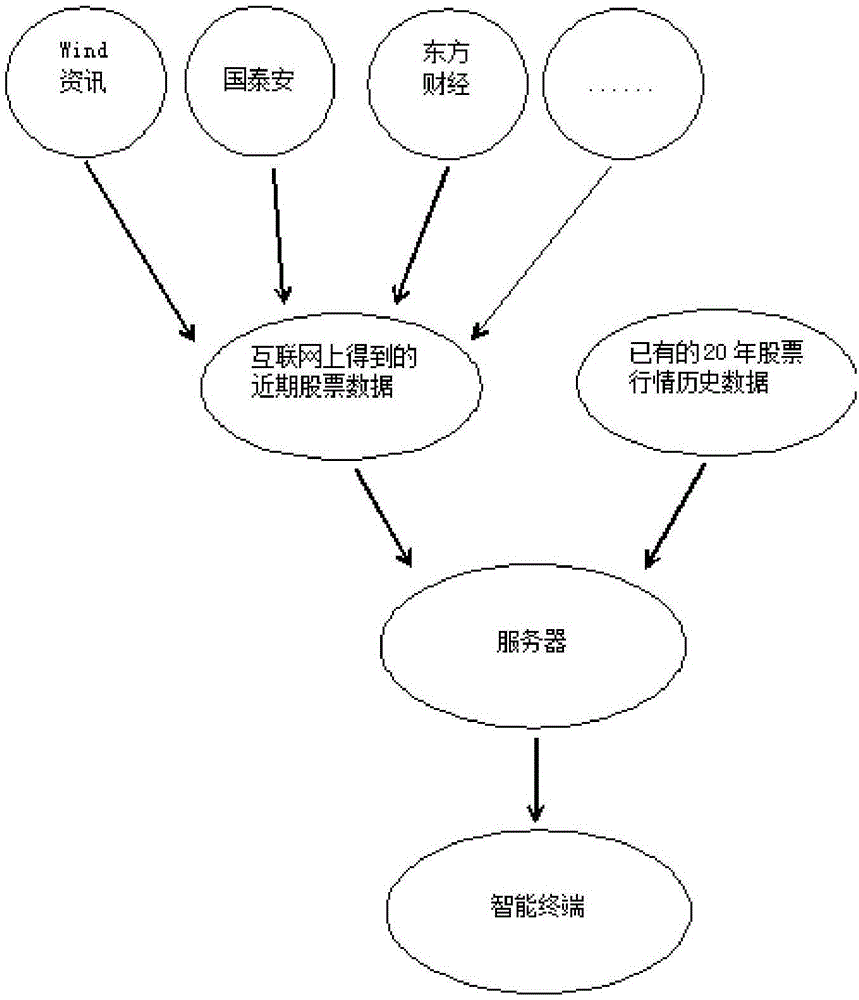

[0024] Such as figure 1 As shown, data providers on the Internet such as wind information, Guotaian, Dongfang Tenpay, etc. provide recent stock market data and 20-year historical stock market data and upload them to the server together, and use the server to perform complex calculations on big data. The obtained stock selection strategy function is pushed to the smart terminal, and in the smart terminal, investors can choose different stock selection strategy functions according to their own needs.

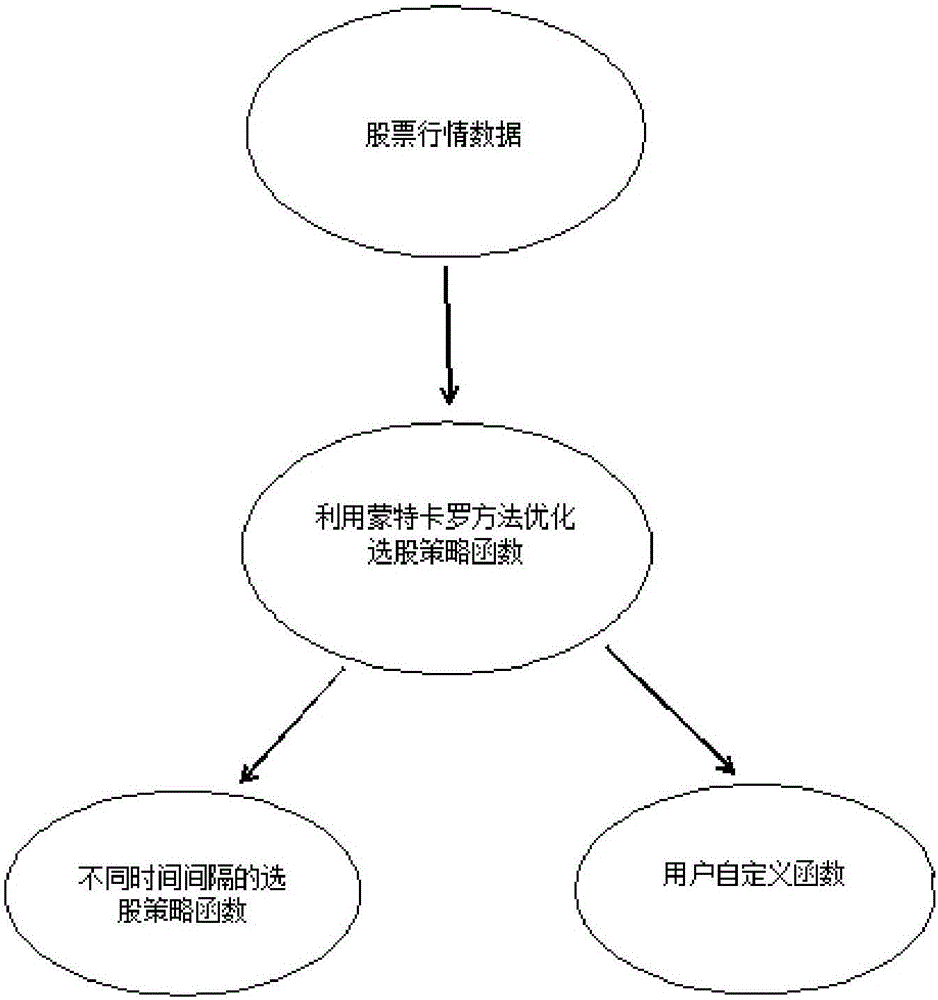

[0025] Such as figure 2 As shown, the software structure includes stock market data, using Monte Carlo method to optimize stock selection strategies, stock selection strategy functions of different time intervals and user-defined functions. Firstly, using the stock market data, the parameter optimization of the stock selection strategy function established by the Monte Carlo method is carried out to obtain a more accurate stock selection strategy function for predicting the stoc...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com