Patents

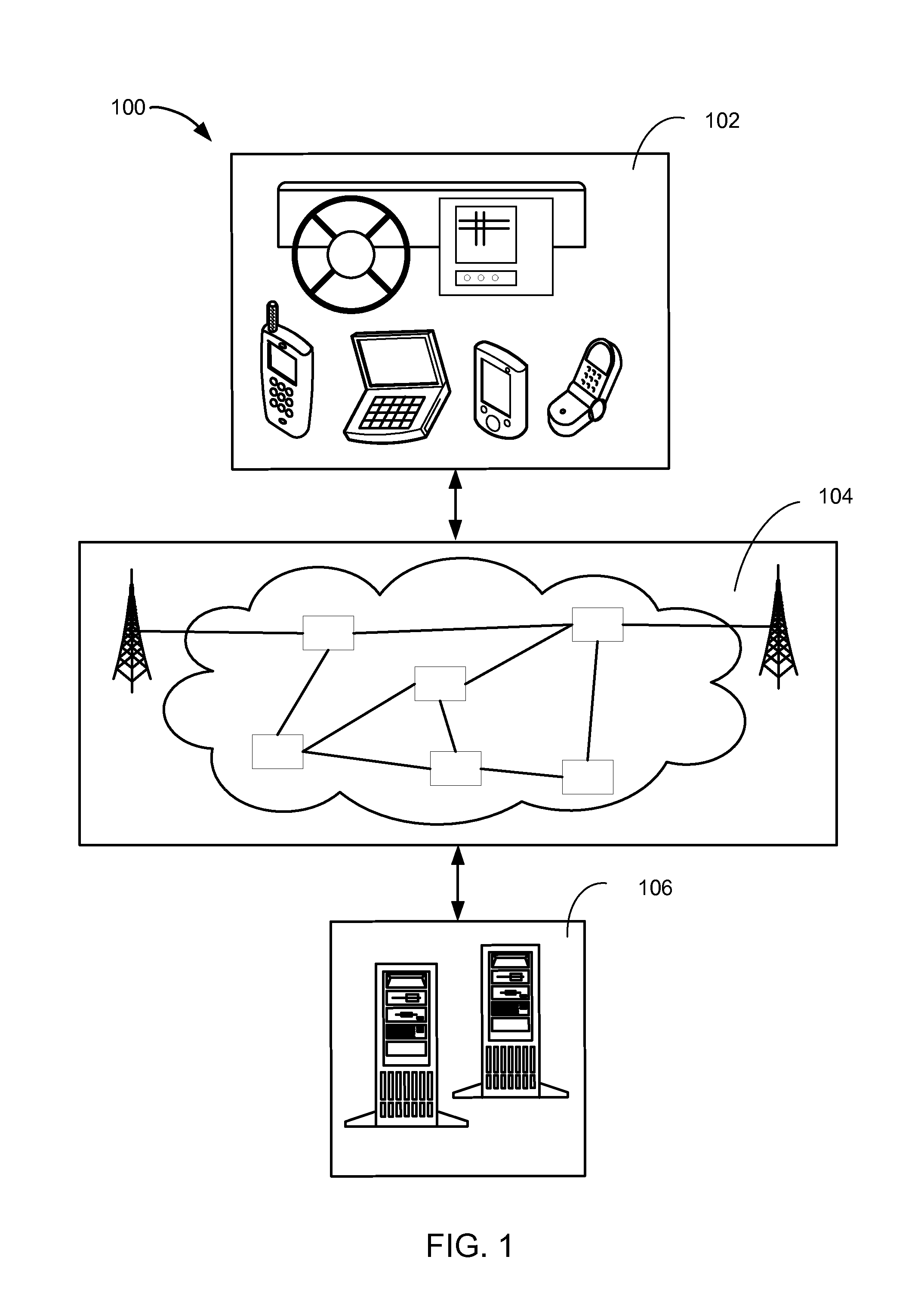

Literature

41000 results about "Machine learning" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

Machine learning (ML) is the scientific study of algorithms and statistical models that computer systems use to perform a specific task without using explicit instructions, relying on patterns and inference instead. It is seen as a subset of artificial intelligence. Machine learning algorithms build a mathematical model based on sample data, known as "training data", in order to make predictions or decisions without being explicitly programmed to perform the task. Machine learning algorithms are used in a wide variety of applications, such as email filtering and computer vision, where it is difficult or infeasible to develop a conventional algorithm for effectively performing the task.

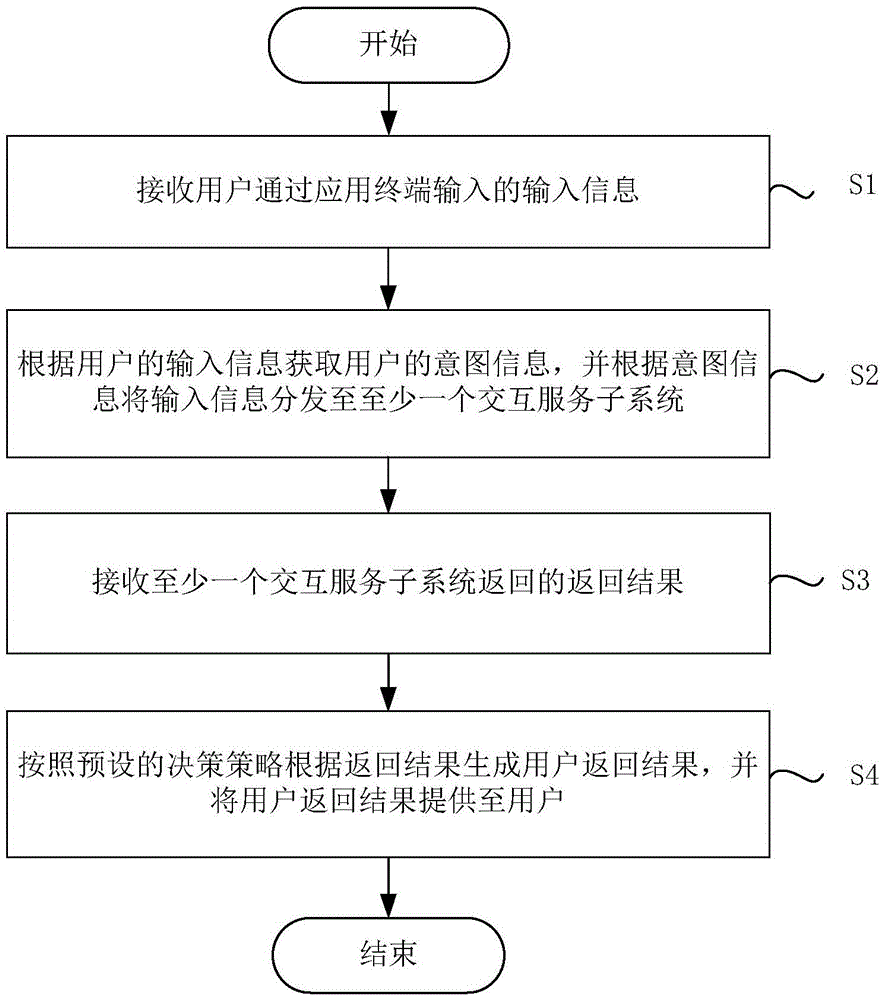

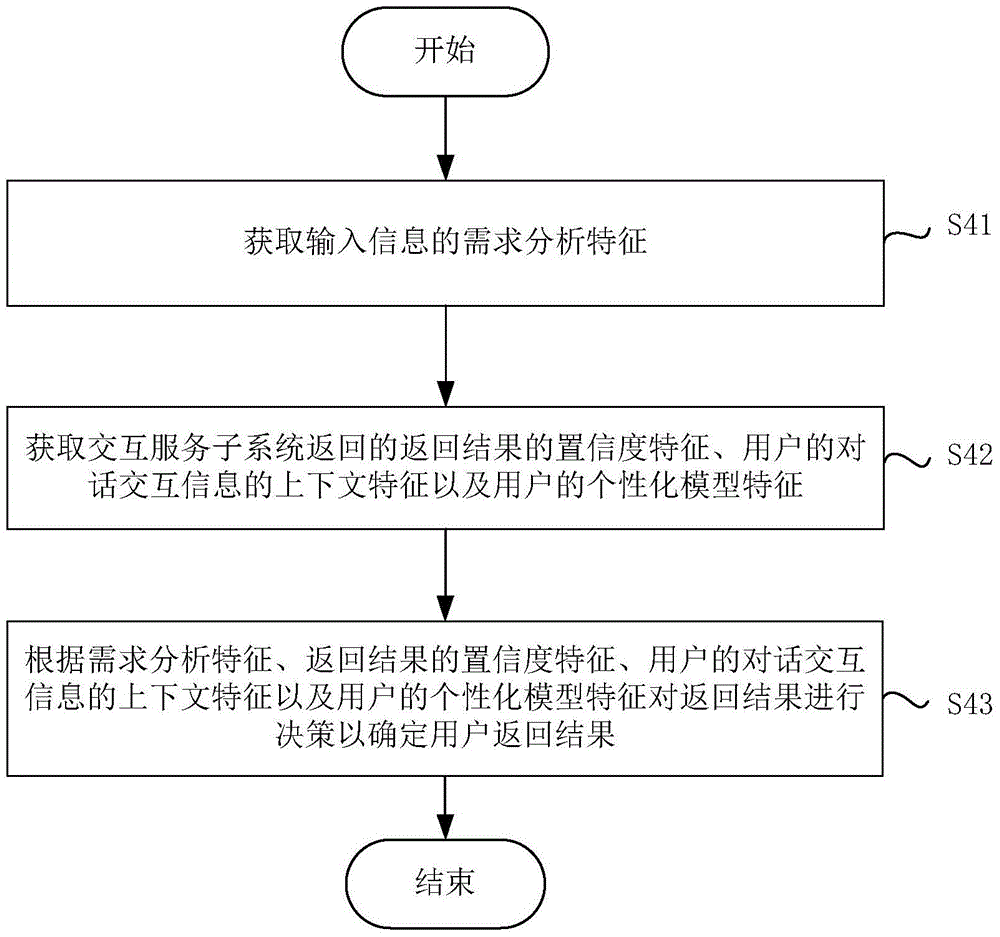

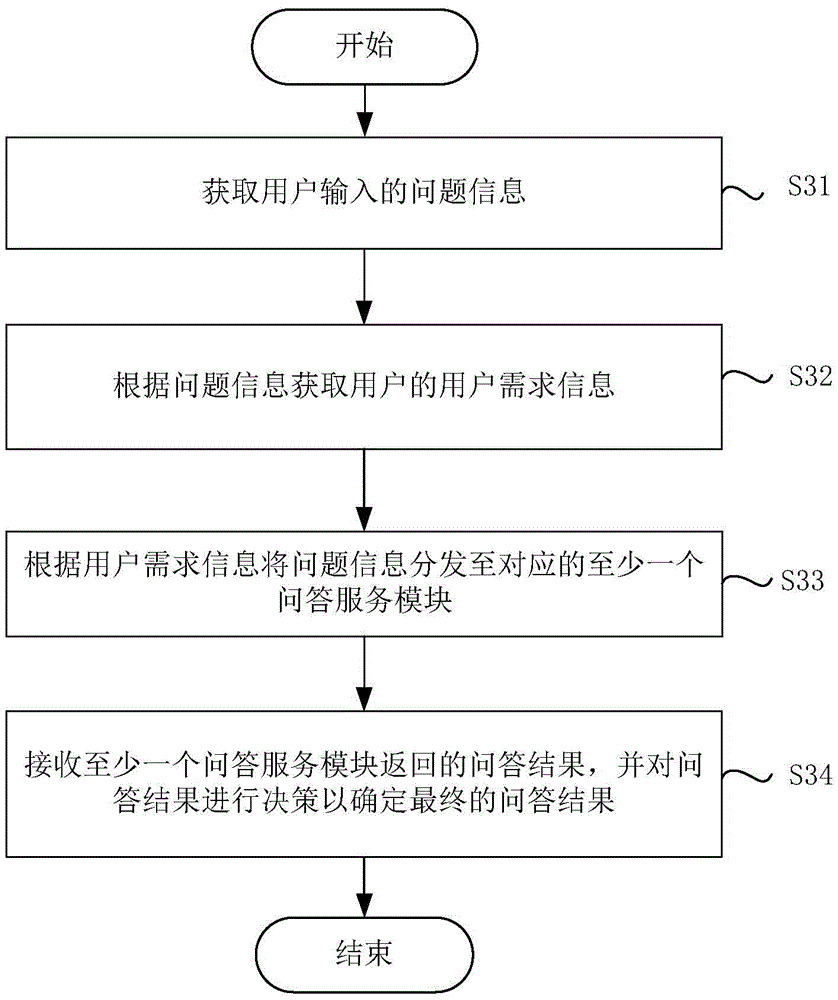

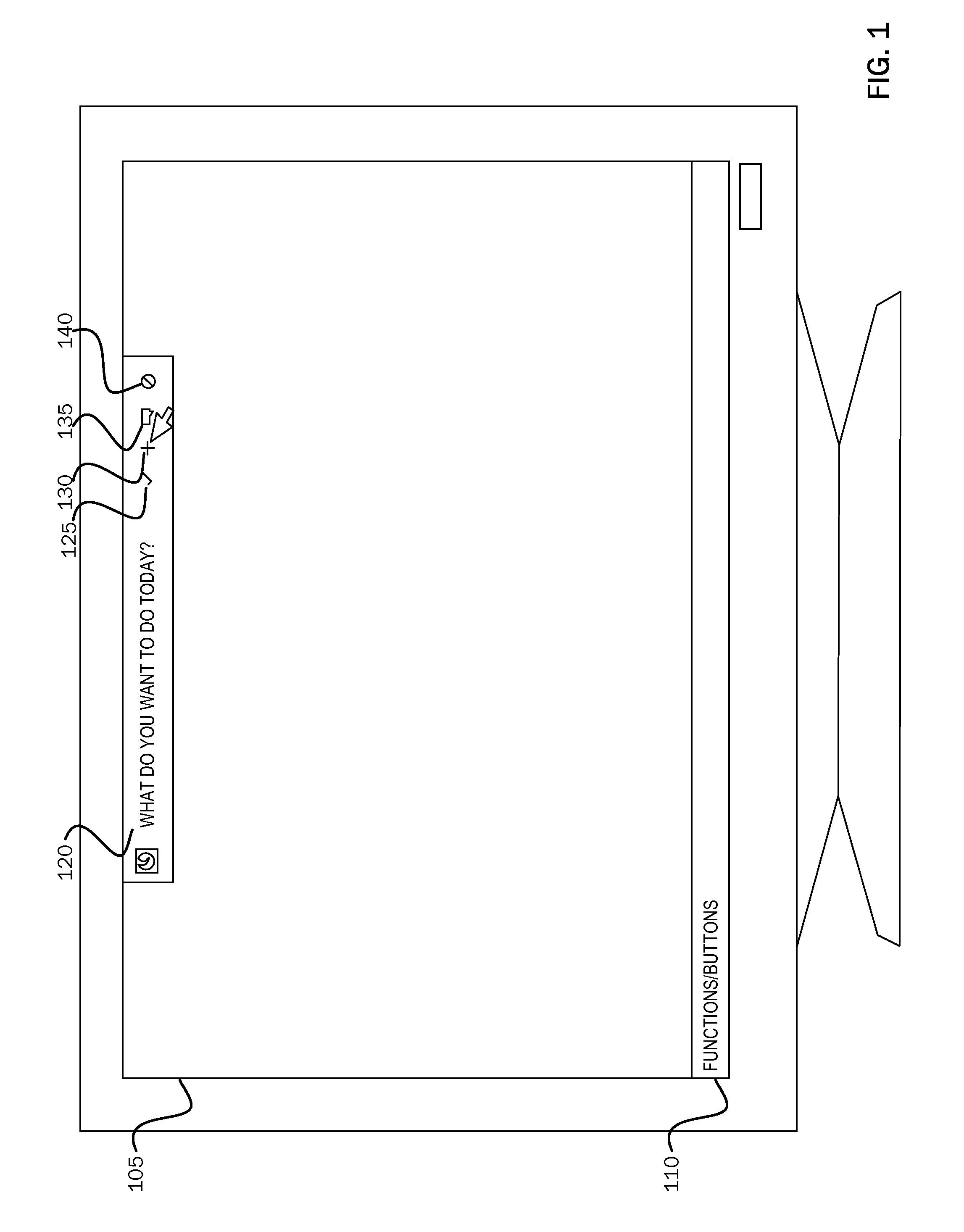

Man-machine interaction method and system based on artificial intelligence

ActiveCN105068661AEasy and pleasant interactive experienceInput/output for user-computer interactionGraph readingDecision strategyComputer terminal

The invention discloses a man-machine interaction method and system based on artificial intelligence. The method includes the following steps of receiving input information input by a user through an application terminal, obtaining the intent information of the user according to the input information of the user, distributing the input information to at least one interaction service subsystem according to the intent information, receiving the return result returned by the interaction service subsystems, generating a user return result according to the return result through a preset decision strategy, and providing the user return result to the user. By means of the method and system, the man-machine interaction system is virtualized instead of being instrumentalized, and the user can obtain the relaxed and pleasure interaction experience in the intelligent interaction process through chat, research and other service. The search in the form of keywords is improved into the search based on natural languages, the user can express demands through flexible and free natural languages, and the multi-round interaction process is closer to the interaction experience among humans.

Owner:BAIDU ONLINE NETWORK TECH (BEIJIBG) CO LTD

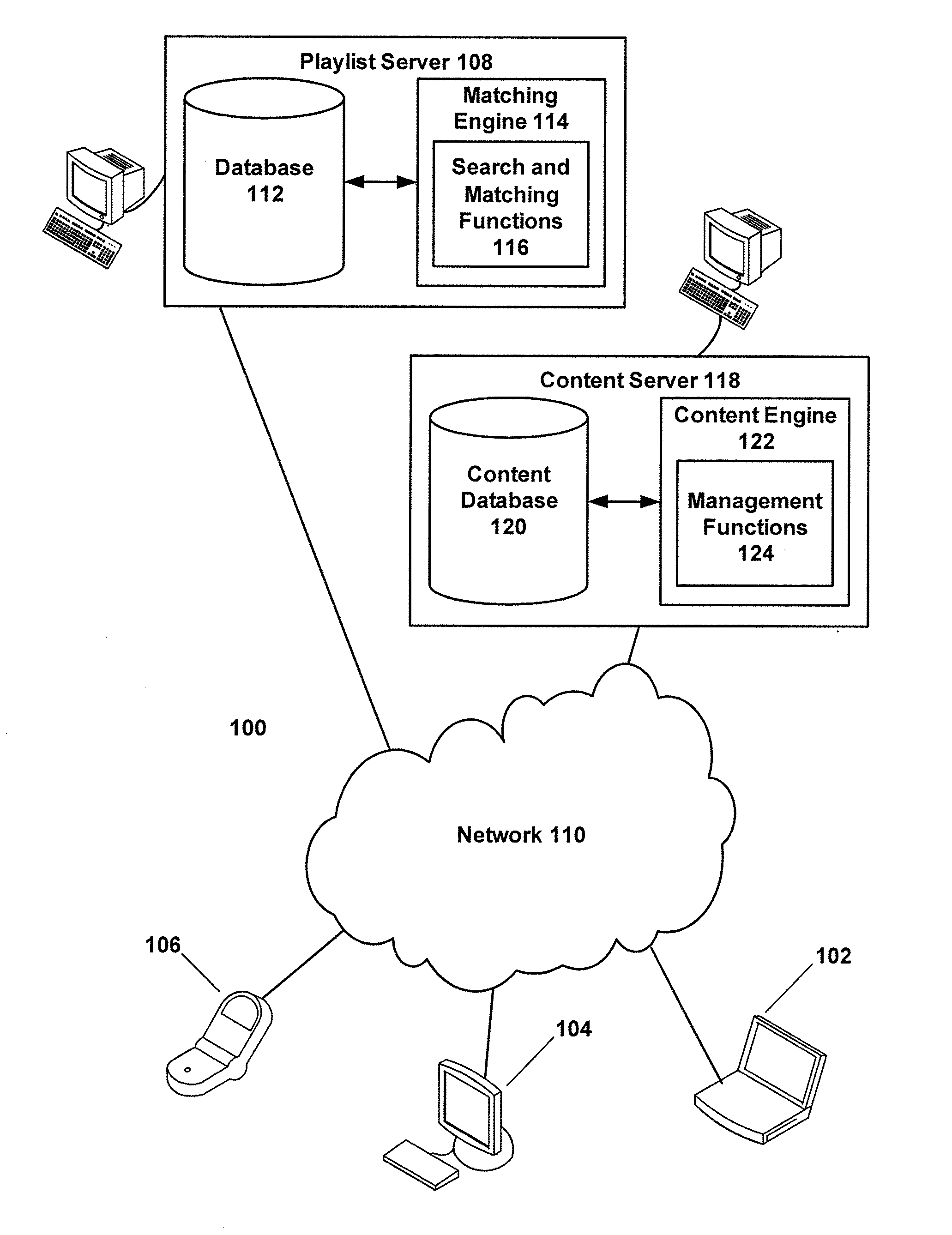

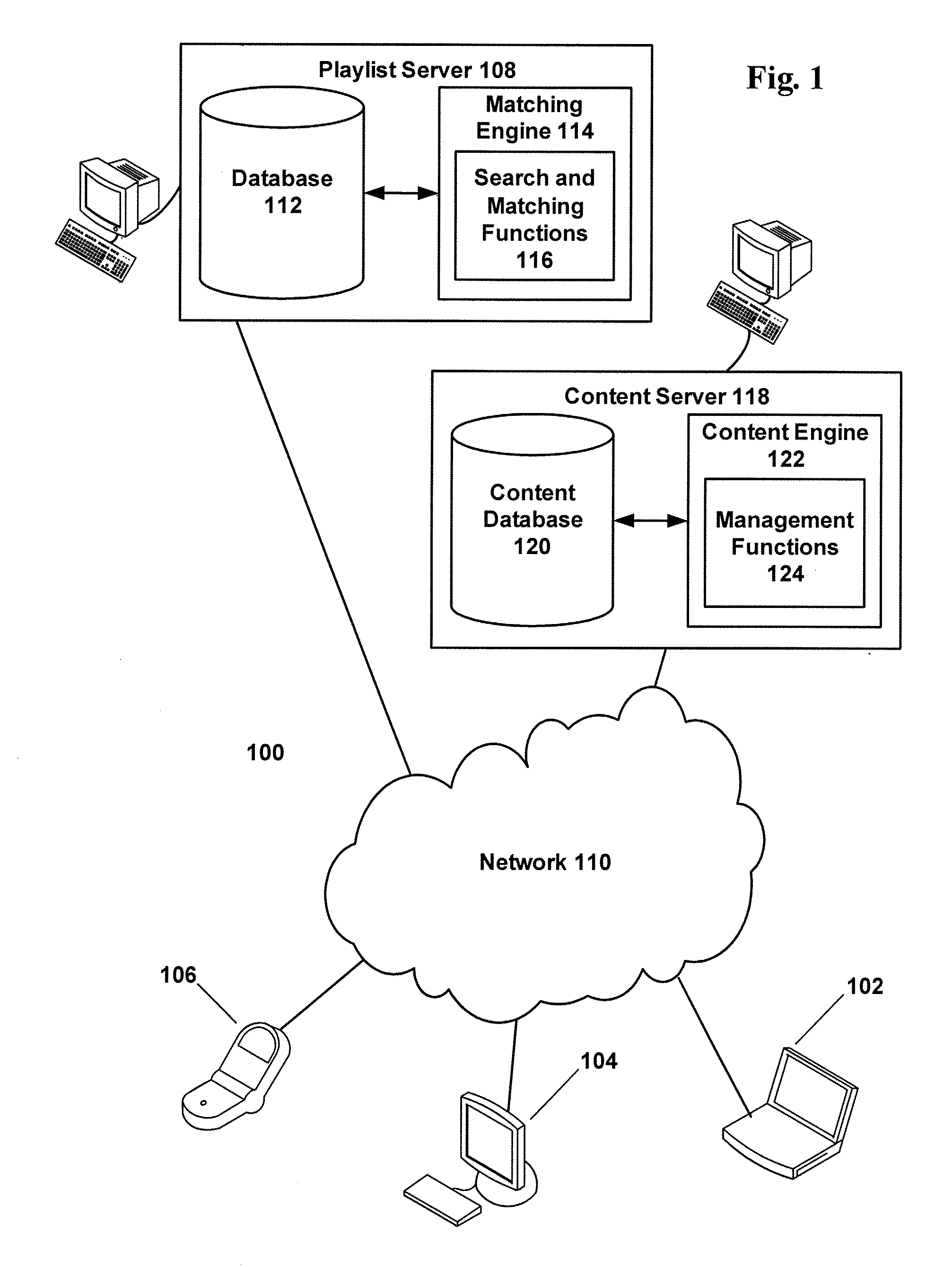

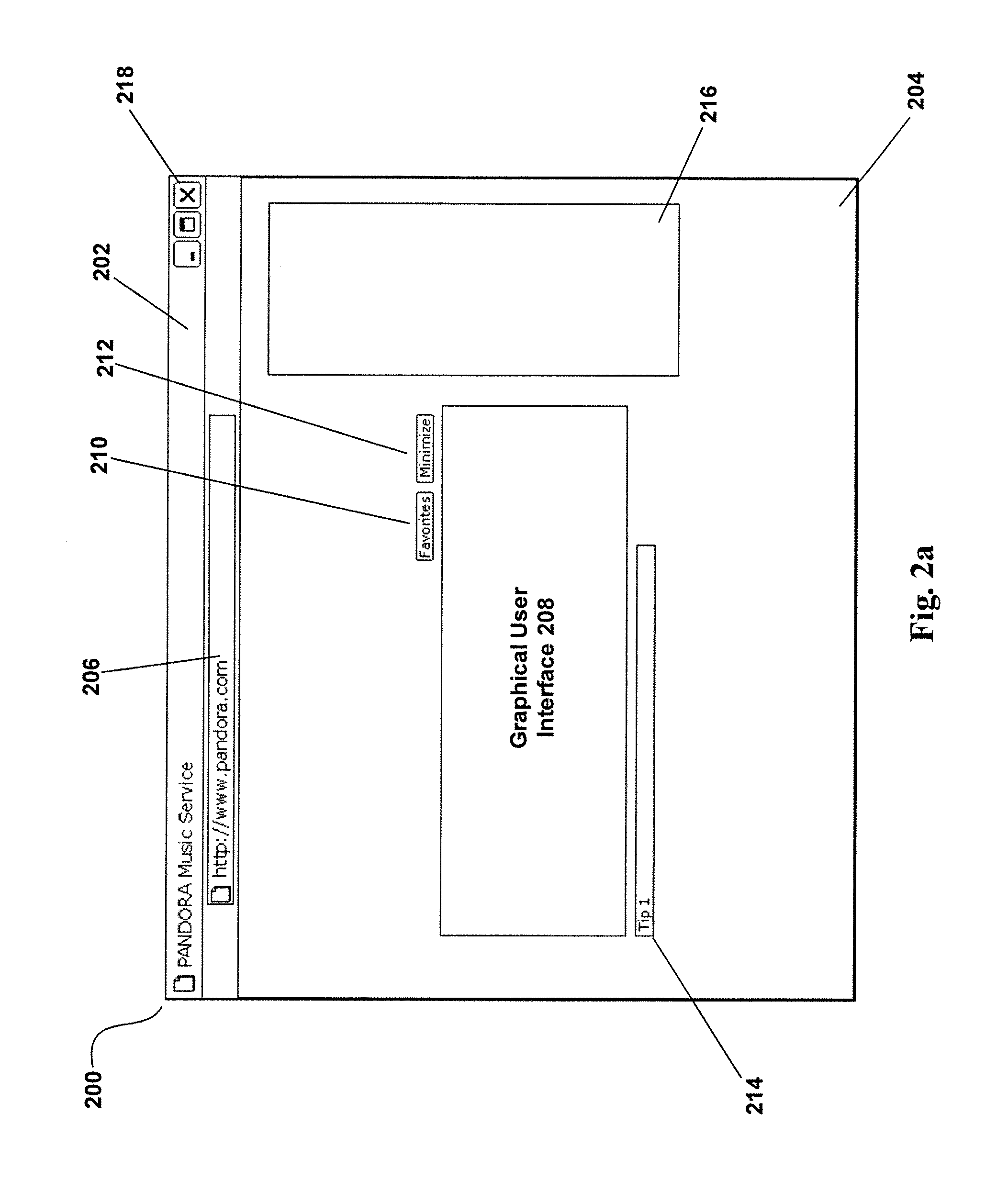

Methods and systems for utilizing contextual feedback to generate and modify playlists

InactiveUS20060212444A1Metadata audio data retrievalDigital data processing detailsMachine learningContextual information

Systems and methods of generating and modifying a playlist using contextual information are disclosed. For example, a user may provide an input seed such as a song name or artist name. The input seed is compared to database items and a playlist is generated as a result. In some examples, the contextual information is used to enhance the comparison and to select better content objects for a user's playlist. Meanwhile, in some examples the content objects in the playlist may be arranged in an enhanced order using ranking and / or contextual information.

Owner:PANDORA MEDIA

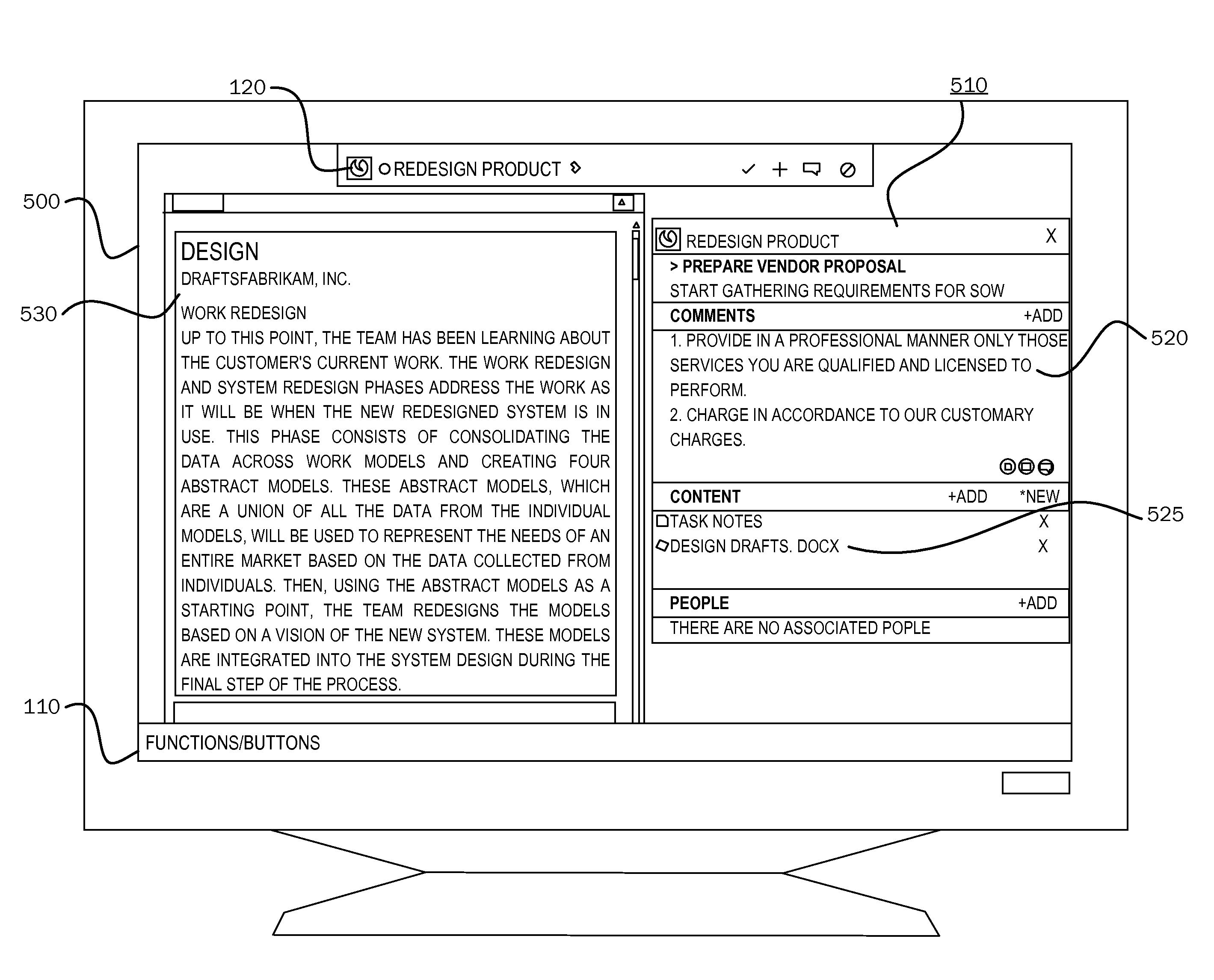

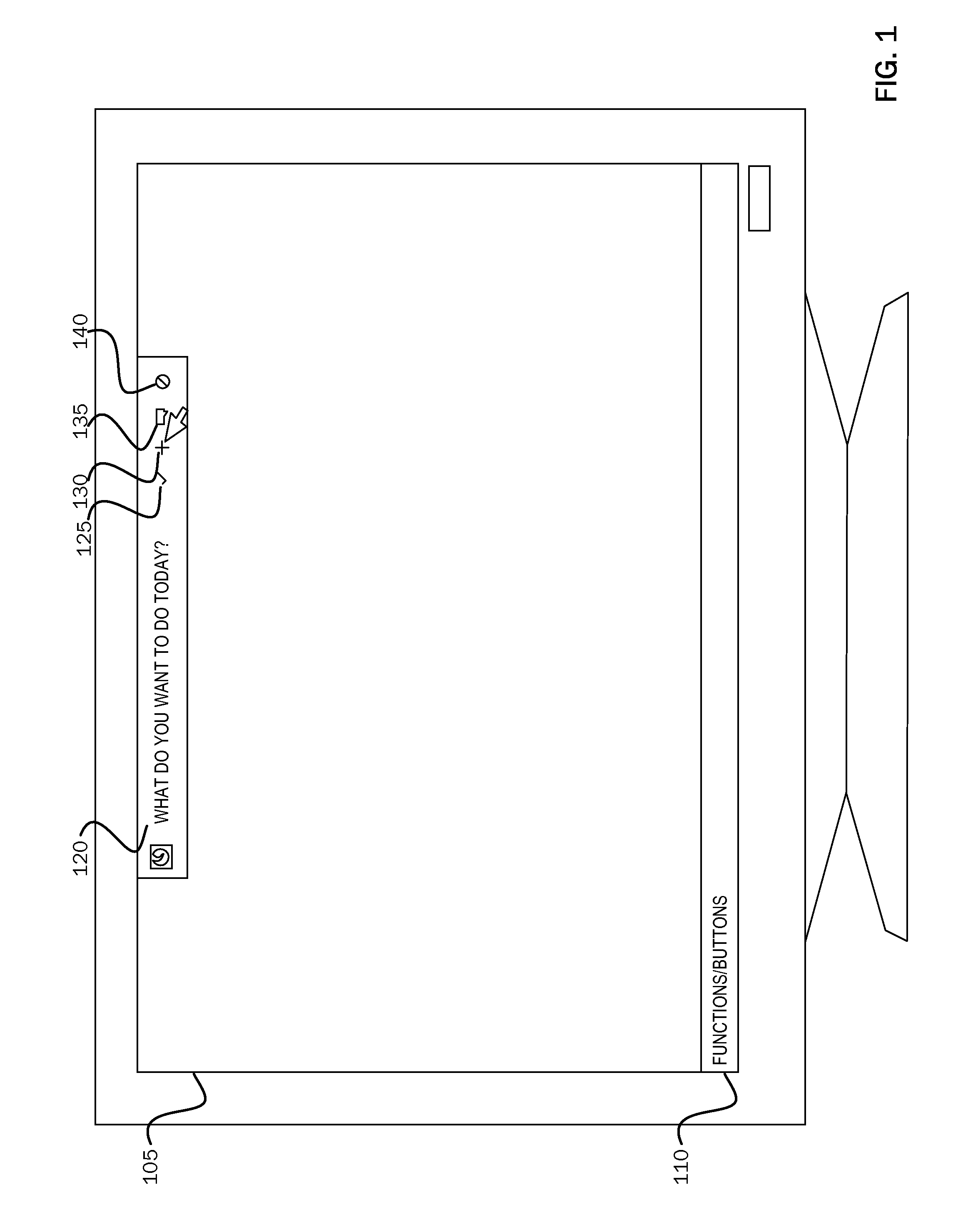

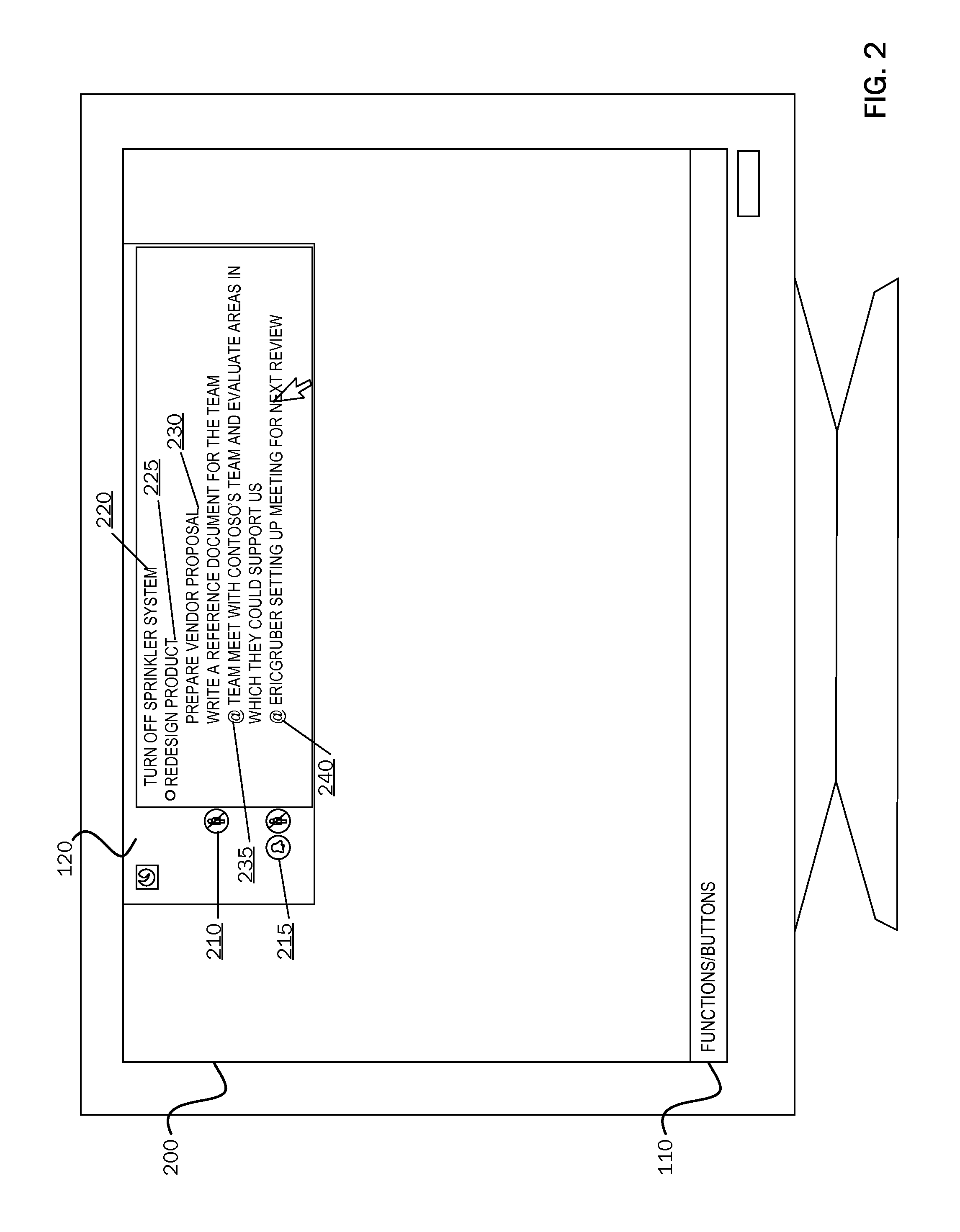

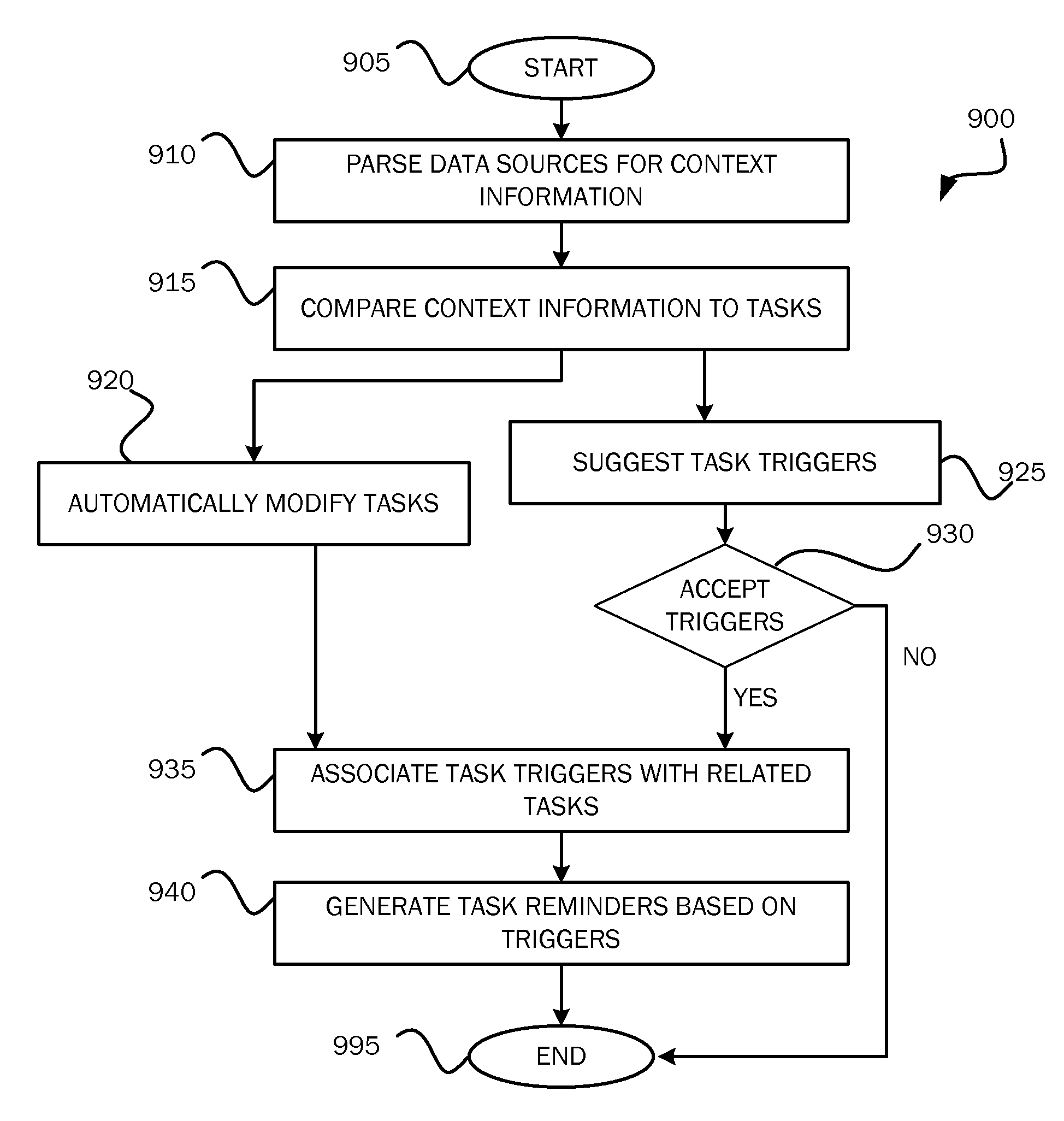

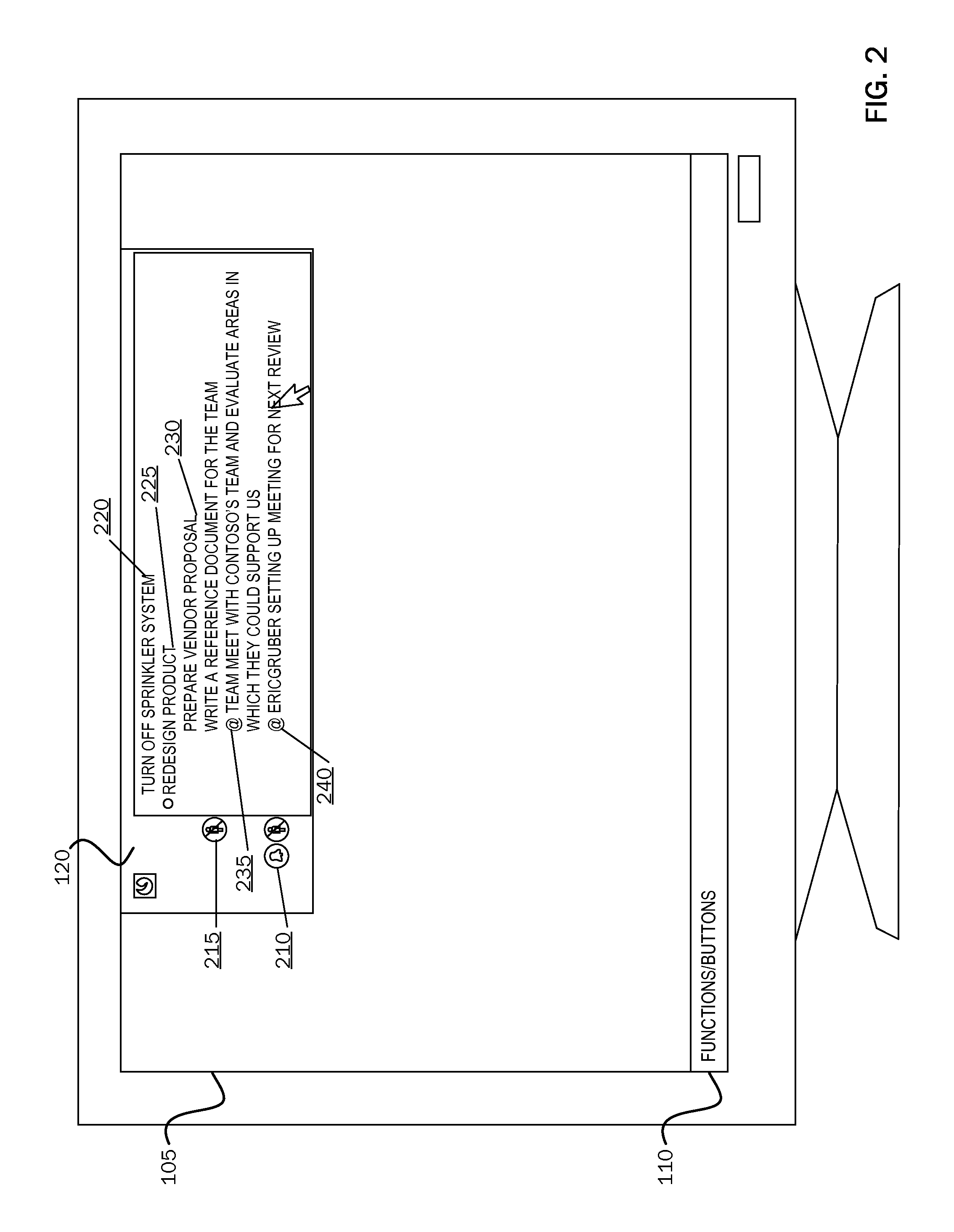

Context-Based Task Generation

ActiveUS20110314404A1Well formedDigital computer detailsSpecial data processing applicationsContext basedMachine learning

A triggering mechanism for generating task reminders based on contextual information associated with the tasks is provided. Contextual information may be extracted from a variety of sources and may be related to one or more tasks. Based on the contextual information, task reminders may be generated and may be presented in a manner that makes the task reminders more useful to an end user.

Owner:MICROSOFT TECH LICENSING LLC

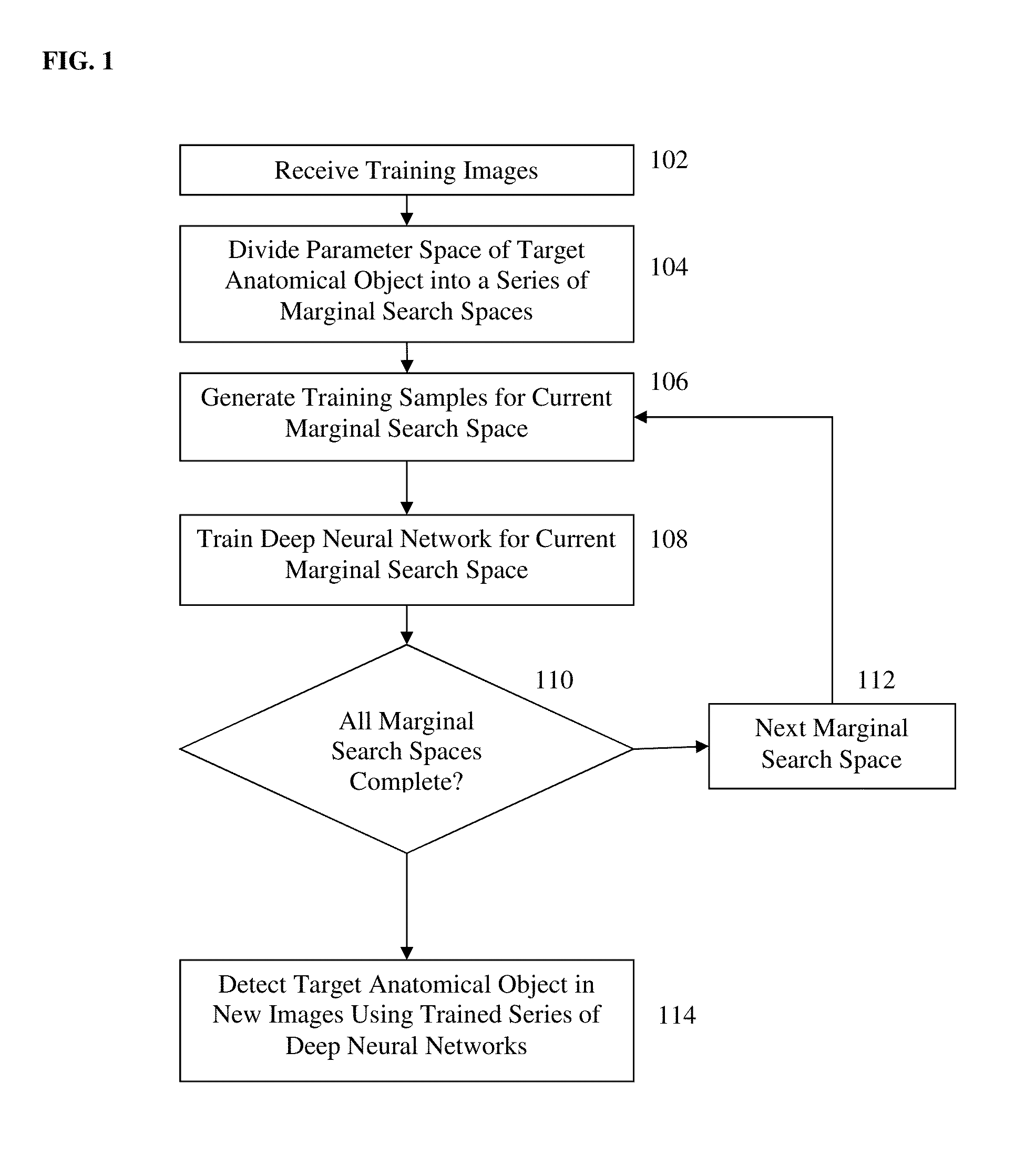

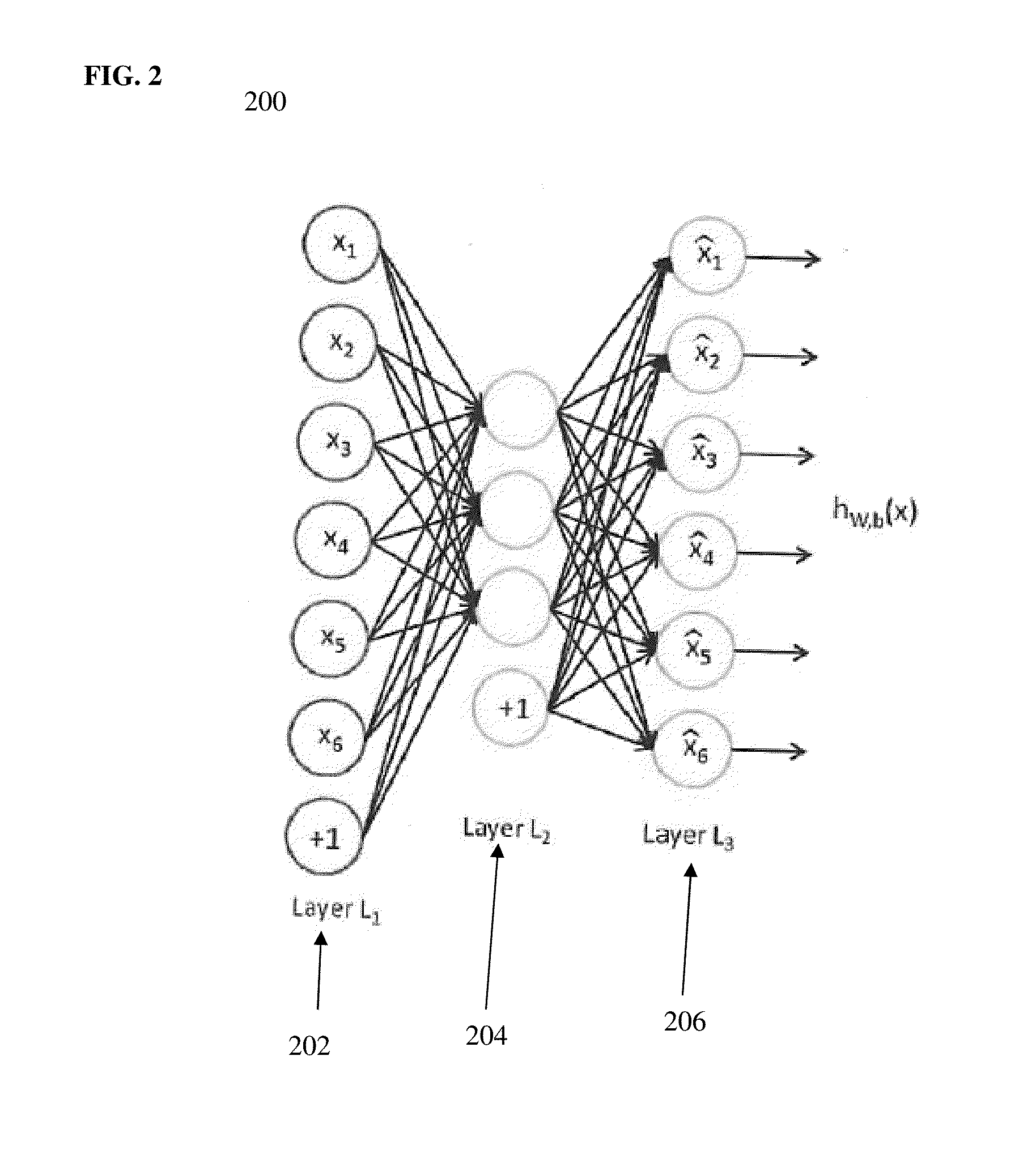

Method and System for Anatomical Object Detection Using Marginal Space Deep Neural Networks

ActiveUS20160174902A1Add dimensionUltrasonic/sonic/infrasonic diagnosticsImage enhancementMachine learningObject detection

A method and system for anatomical object detection using marginal space deep neural networks is disclosed. The pose parameter space for an anatomical object is divided into a series of marginal search spaces with increasing dimensionality. A respective sparse deep neural network is trained for each of the marginal search spaces, resulting in a series of trained sparse deep neural networks. Each of the trained sparse deep neural networks is trained by injecting sparsity into a deep neural network by removing filter weights of the deep neural network.

Owner:SIEMENS HEALTHCARE GMBH

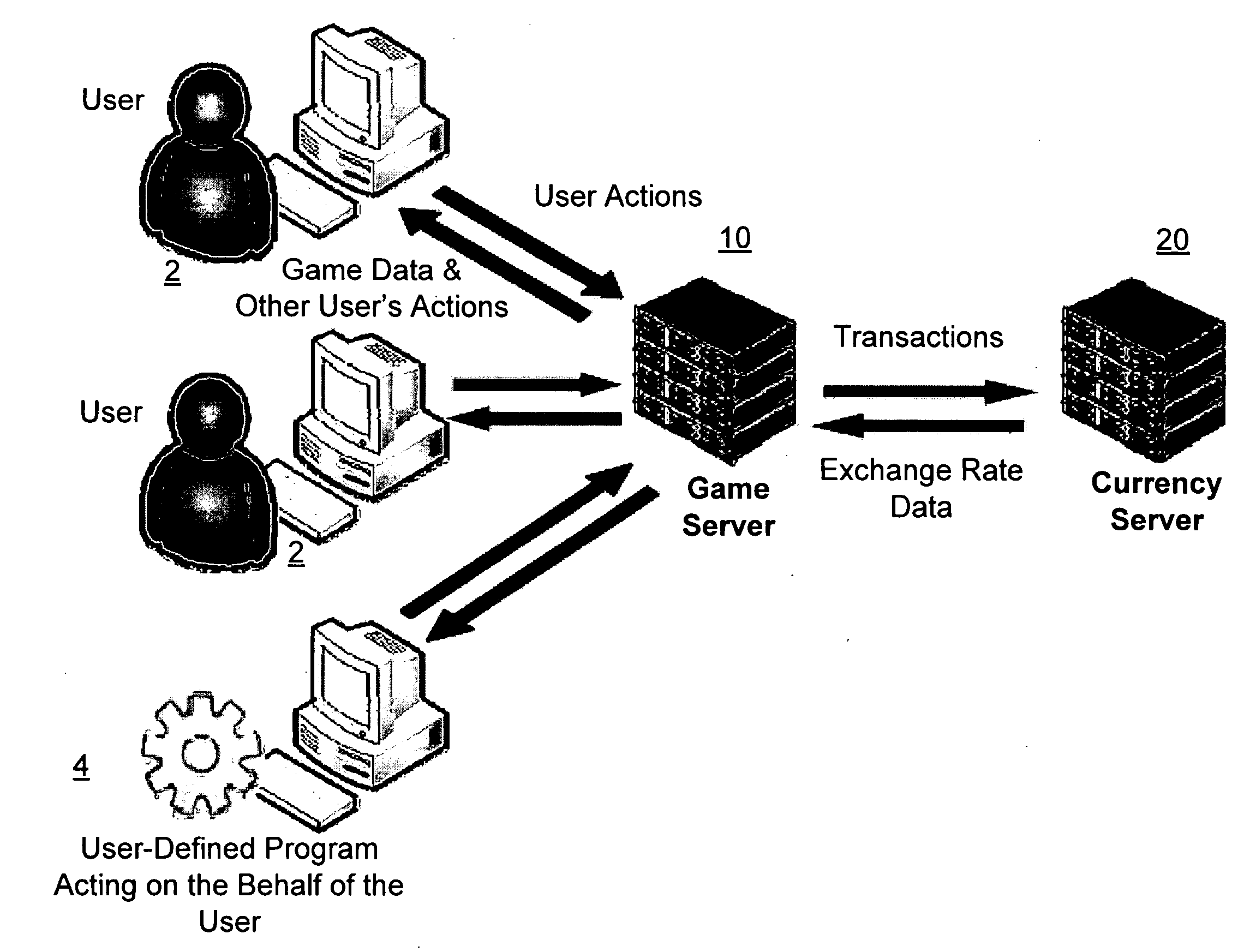

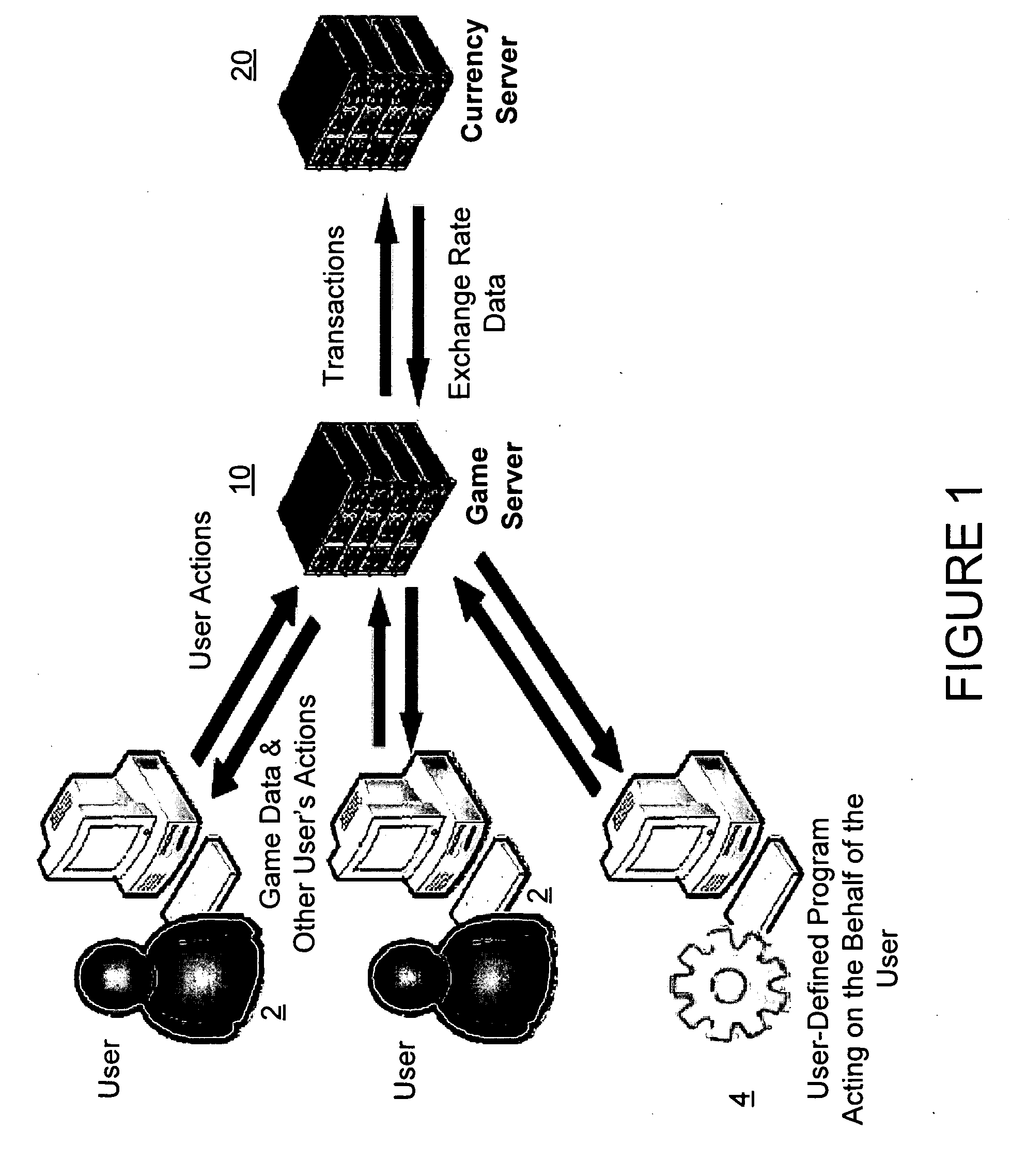

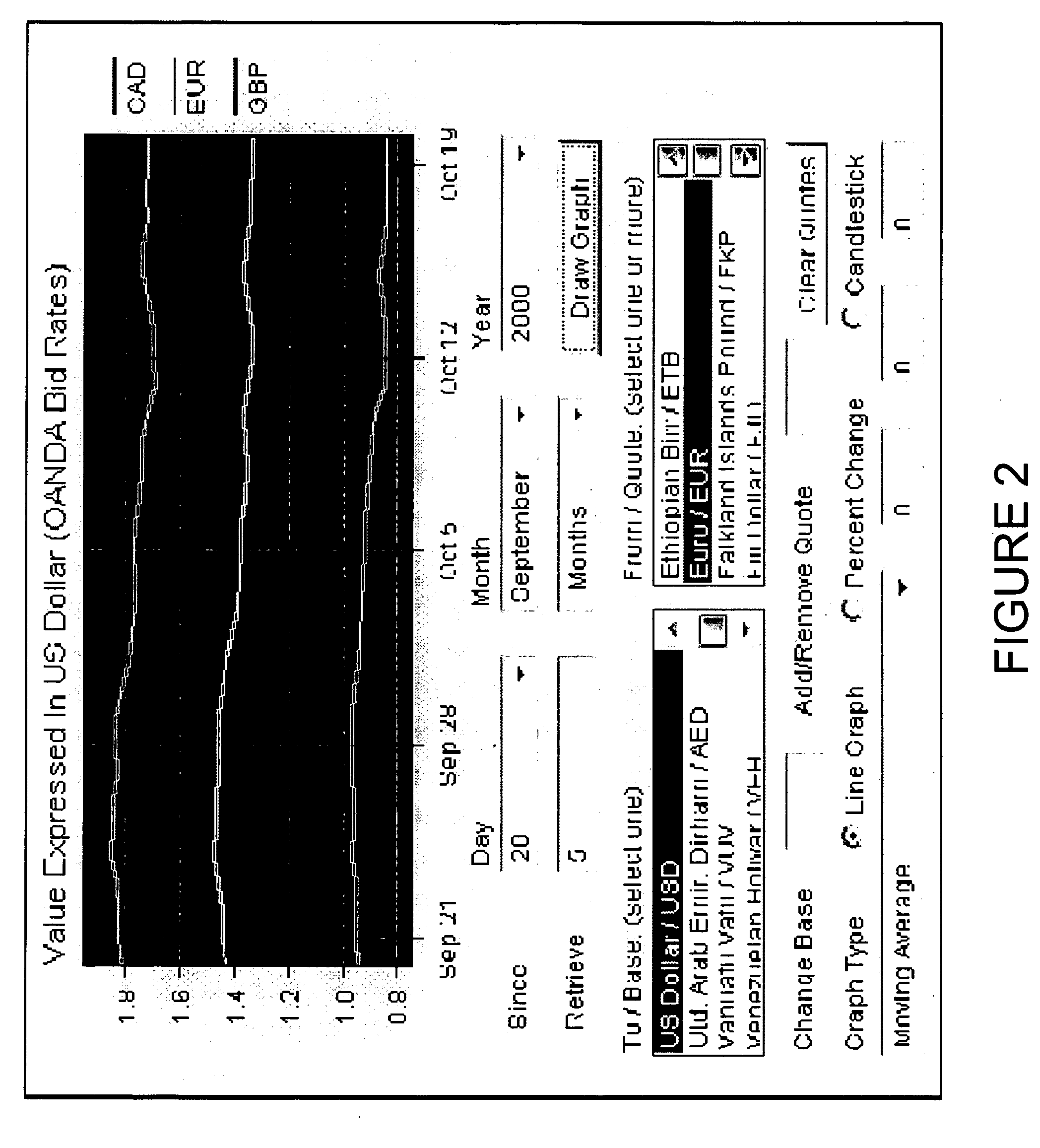

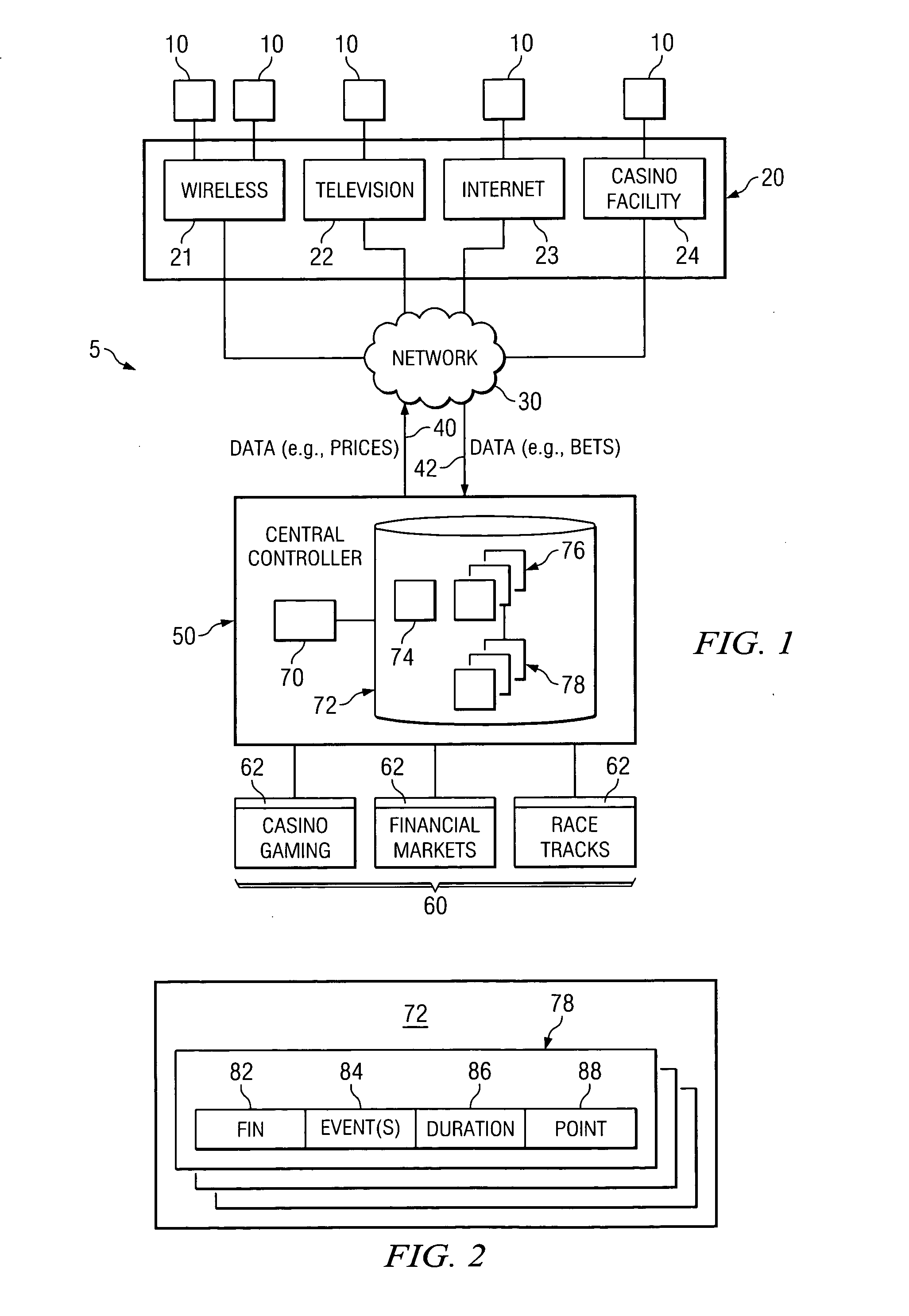

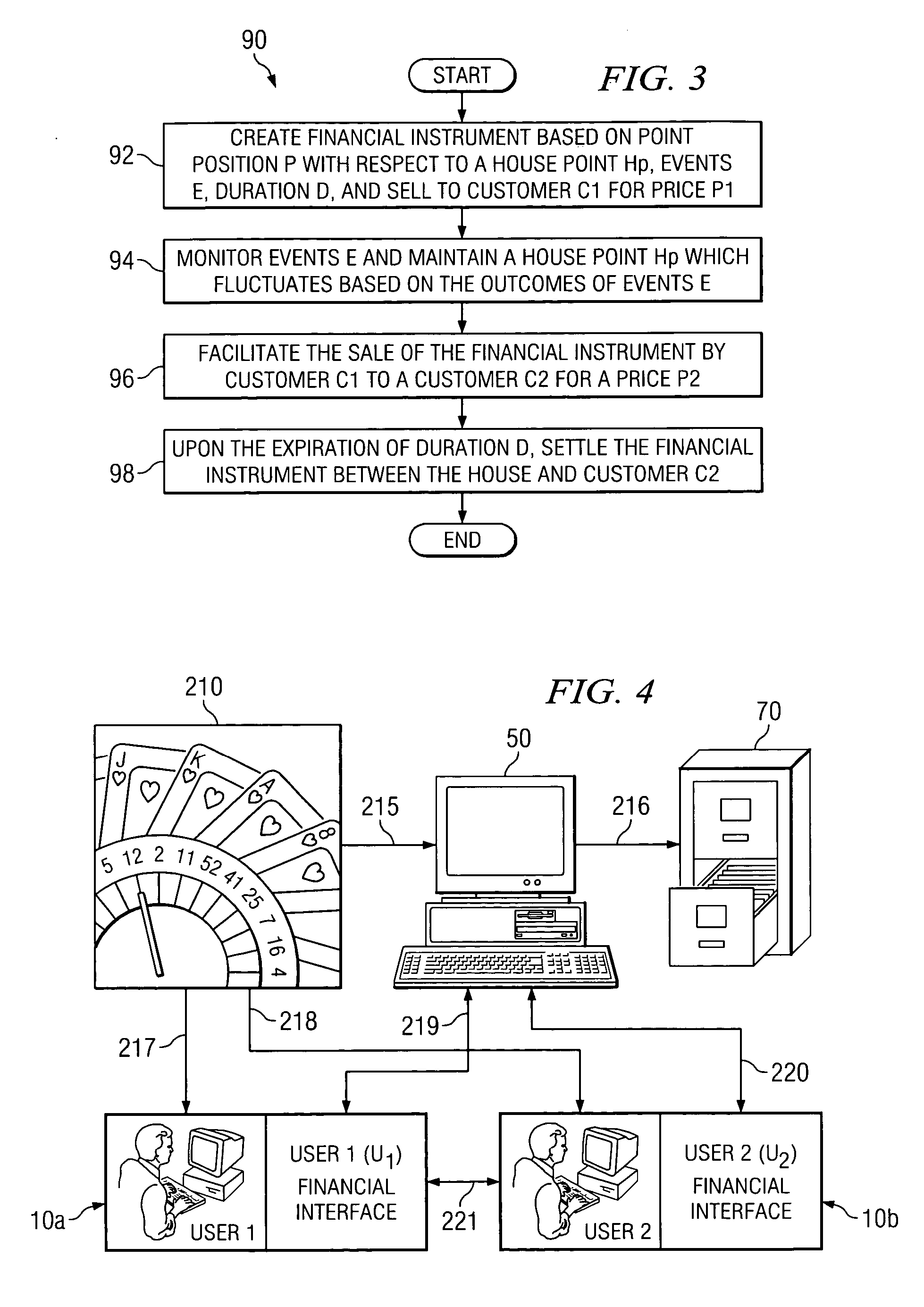

Network computer game linked to real-time financial data

InactiveUS20090181777A1Apparatus for meter-controlled dispensingVideo gamesFinancial transactionMarket based

A network-based computer game that both uses real-time financial data to affect game state and uses participants' actions to determine and engage in financial transactions. A game server receives financial data on market conditions (such as currency markets) from a financial server and regularly synchronizes user's game environments to match the financial data. The game server propagates financial data to the game or games, coordinates communication (if any) between the games, and can initiate the opening and closing of positions in the financial market based on players' game behavior. The financial market can be a currency market, where one nation's currency can be exchanged for another currency at a certain exchange rate.

Owner:FINANCIAL DATA GAMES

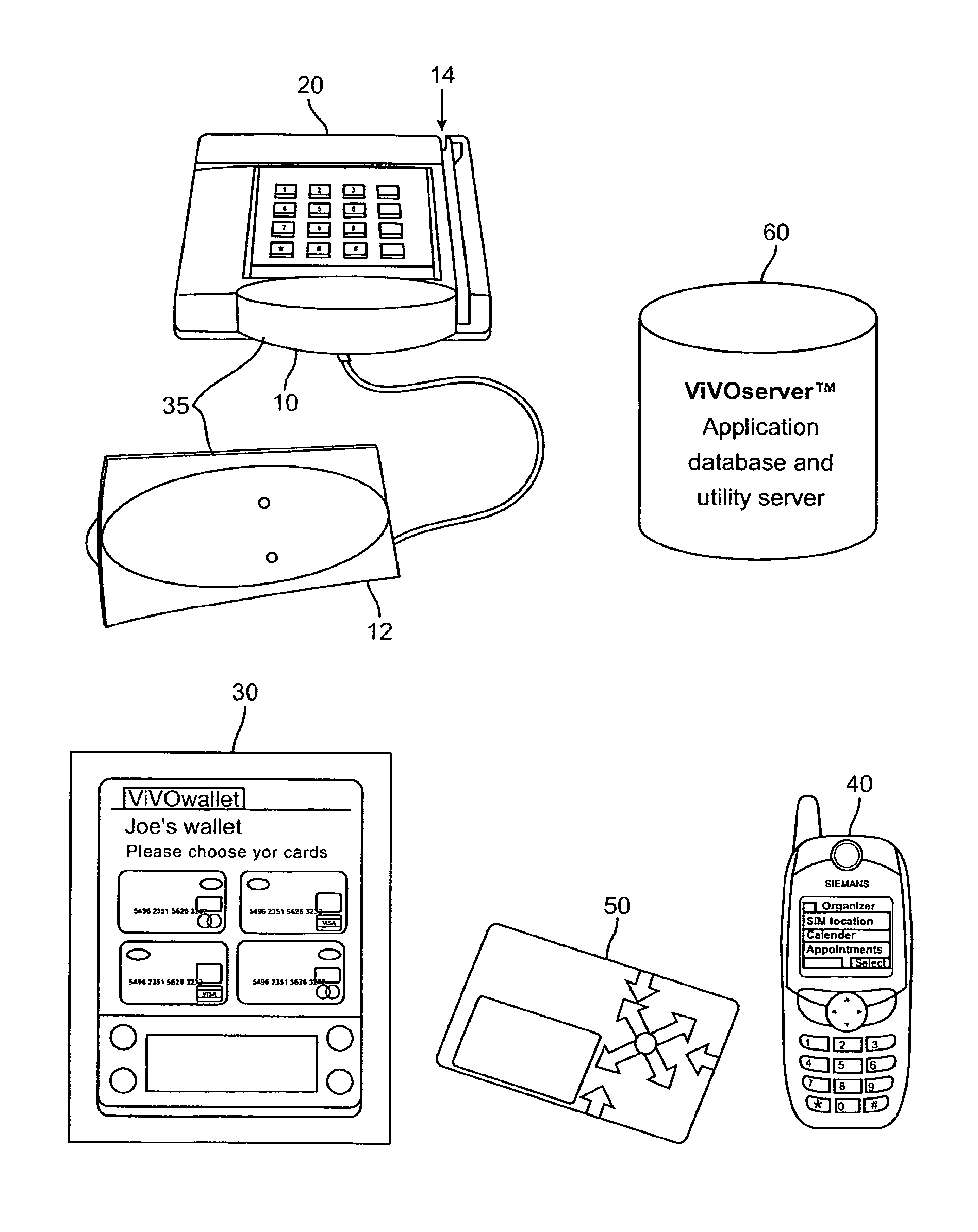

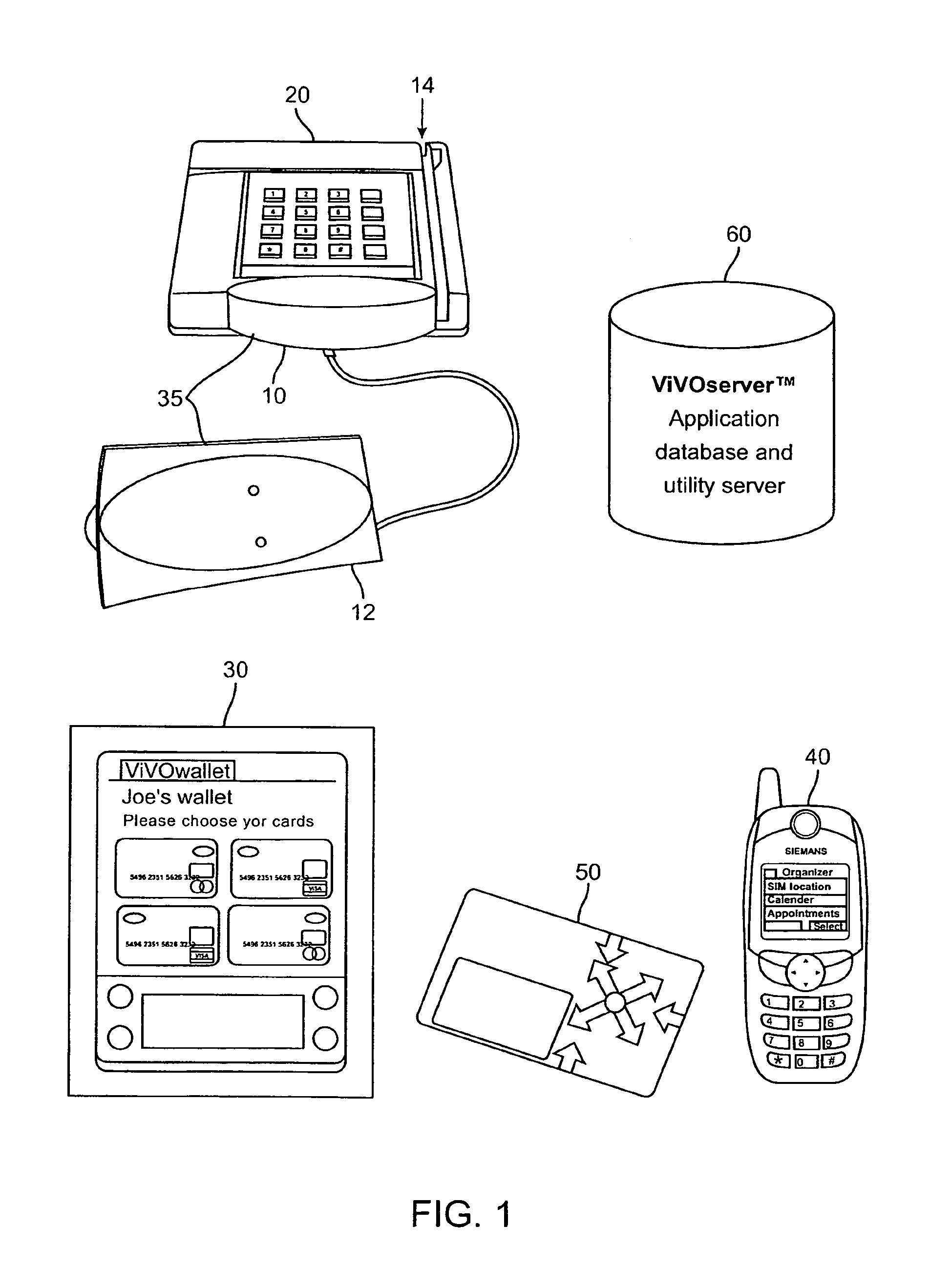

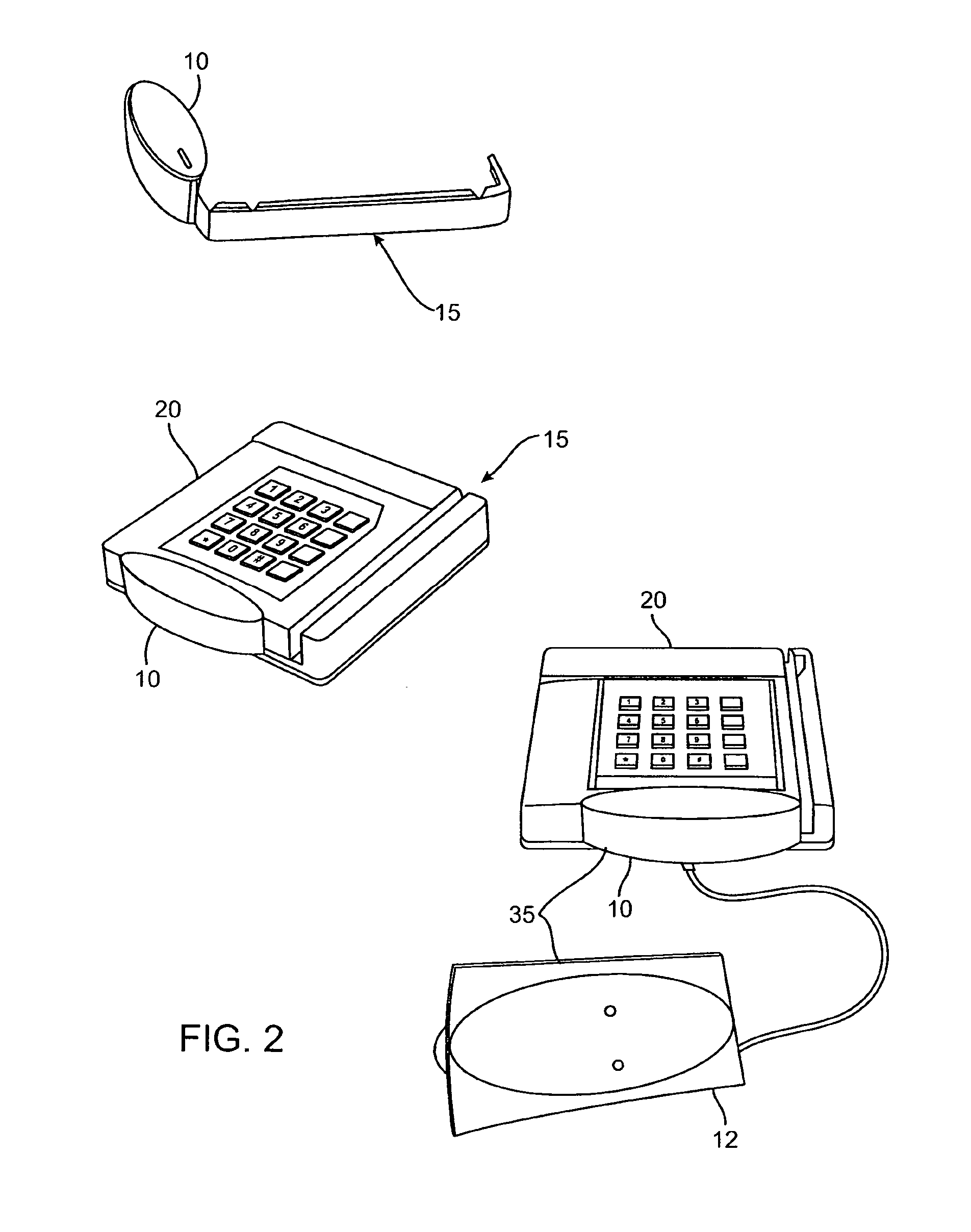

Collaborative negotiation techniques for mobile personal trusted device financial transactions

Techniques for negotiation techniques for mobile personal trusted device financial transactions are provided. A user of a mobile personal trusted device sets user preferences that define the user's preferred parameters for conducting financial transactions. A merchant sets merchant preferences that define the merchant's preferred parameters for conducting financial transactions. When a financial transaction is initiated, a user preference and a merchant preferences are accessed. A negotiated preference is generated that accommodates both the user preference and the merchant preference. If the user preference and the merchant preference are not mutually exclusive, the negotiated preference attempts to satisfy both preferences. If the user preference and the merchant preference are mutually exclusive, the negotiated preference satisfies at least one of the two preferences based on which of the two preferences has a higher priority. The financial transaction is conducted based on the negotiated preference.

Owner:MASTERCARD INT INC

Context-based task generation

ActiveUS8375320B2Multiple digital computer combinationsSpecial data processing applicationsContext basedMachine learning

A triggering mechanism for generating task reminders based on contextual information associated with the tasks is provided. Contextual information may be extracted from a variety of sources and may be related to one or more tasks. Based on the contextual information, task reminders may be generated and may be presented in a manner that makes the task reminders more useful to an end user.

Owner:MICROSOFT TECH LICENSING LLC

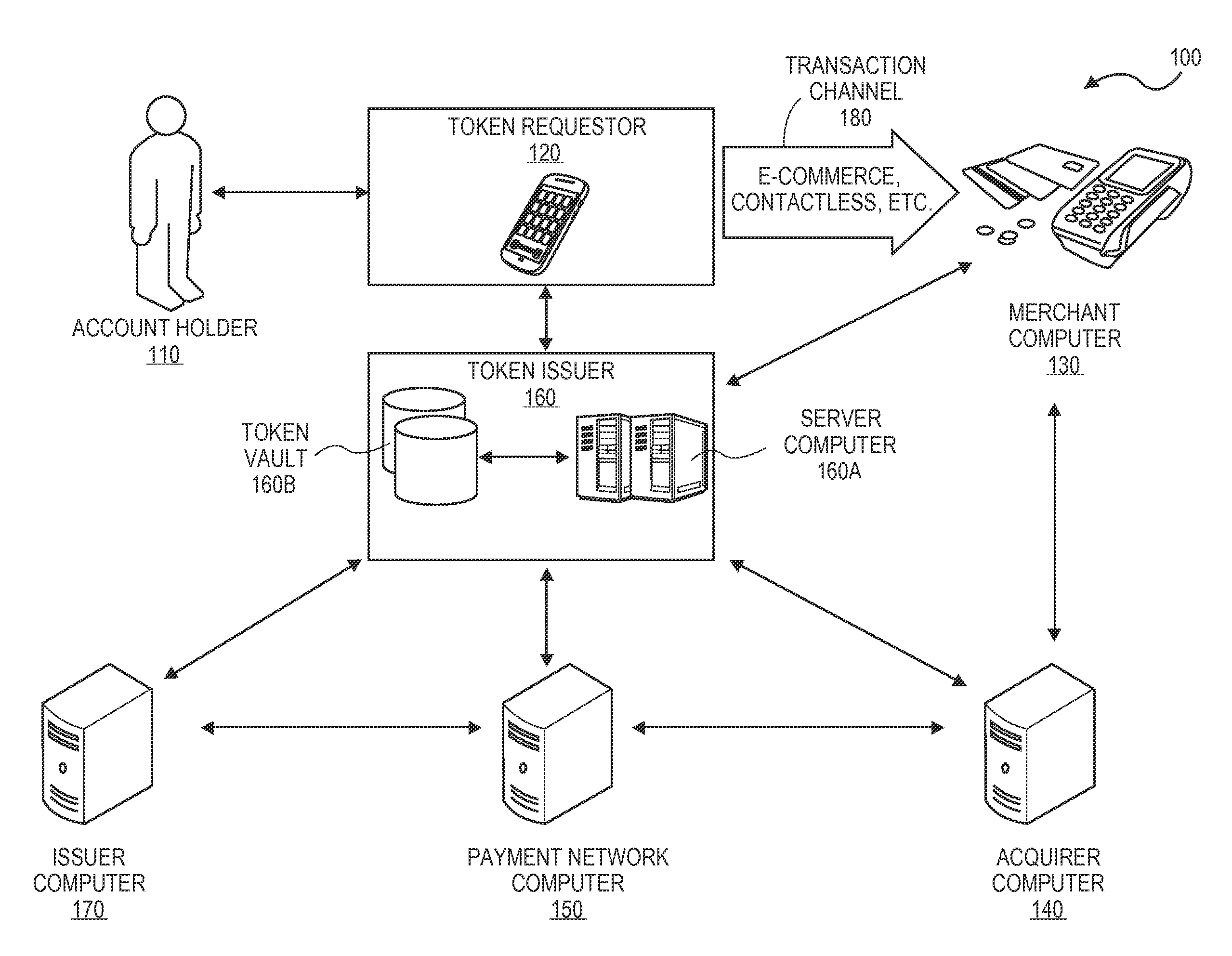

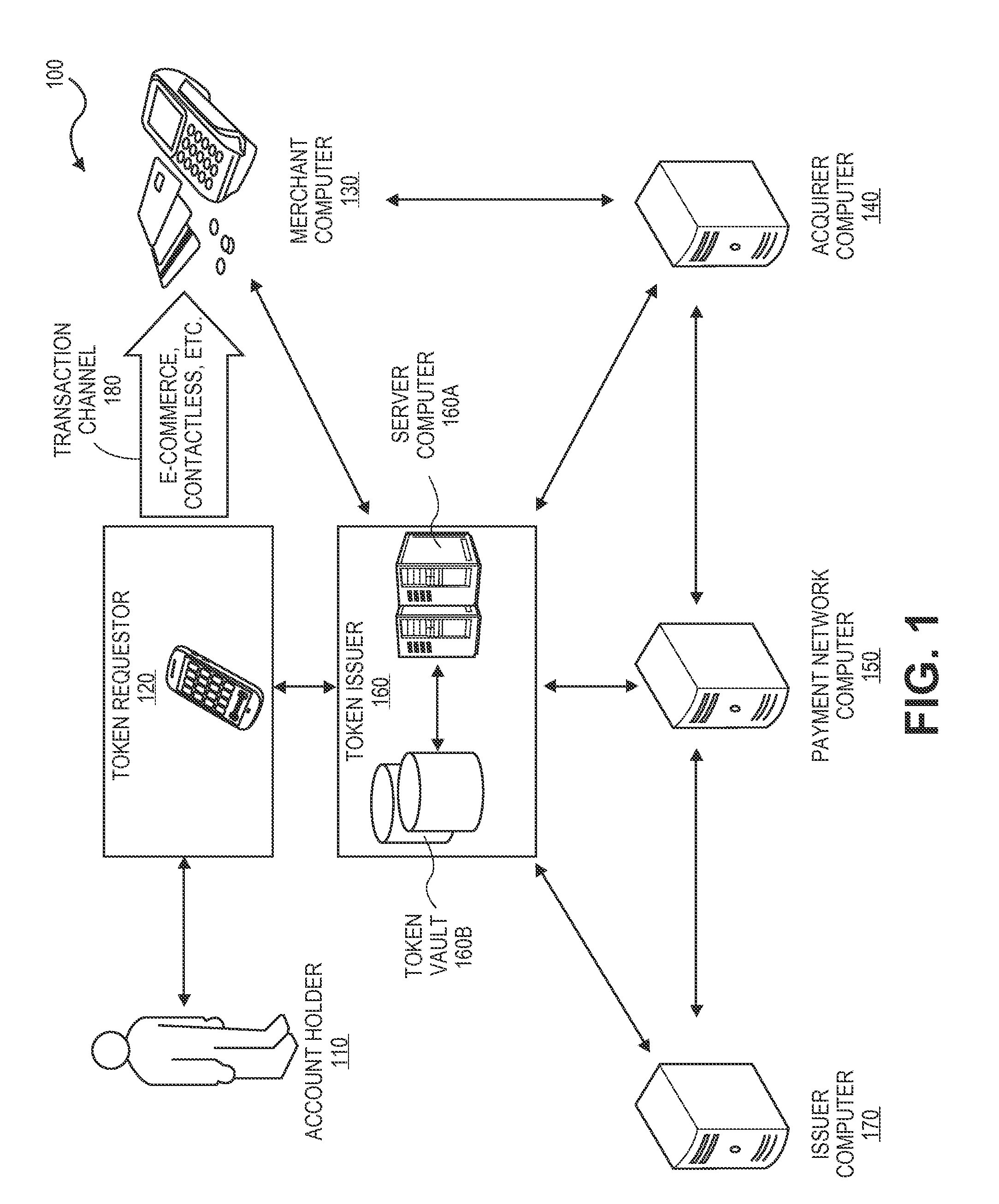

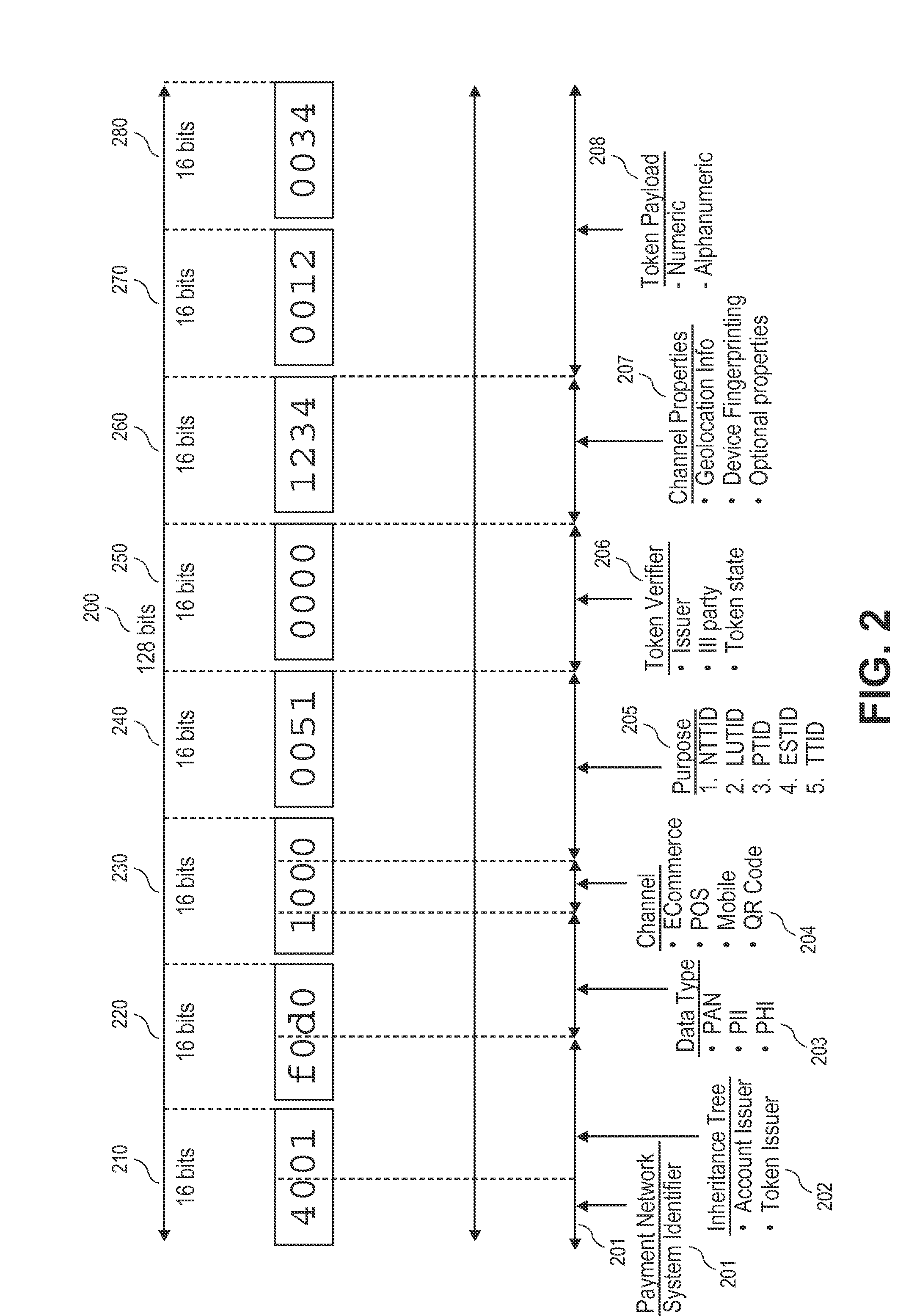

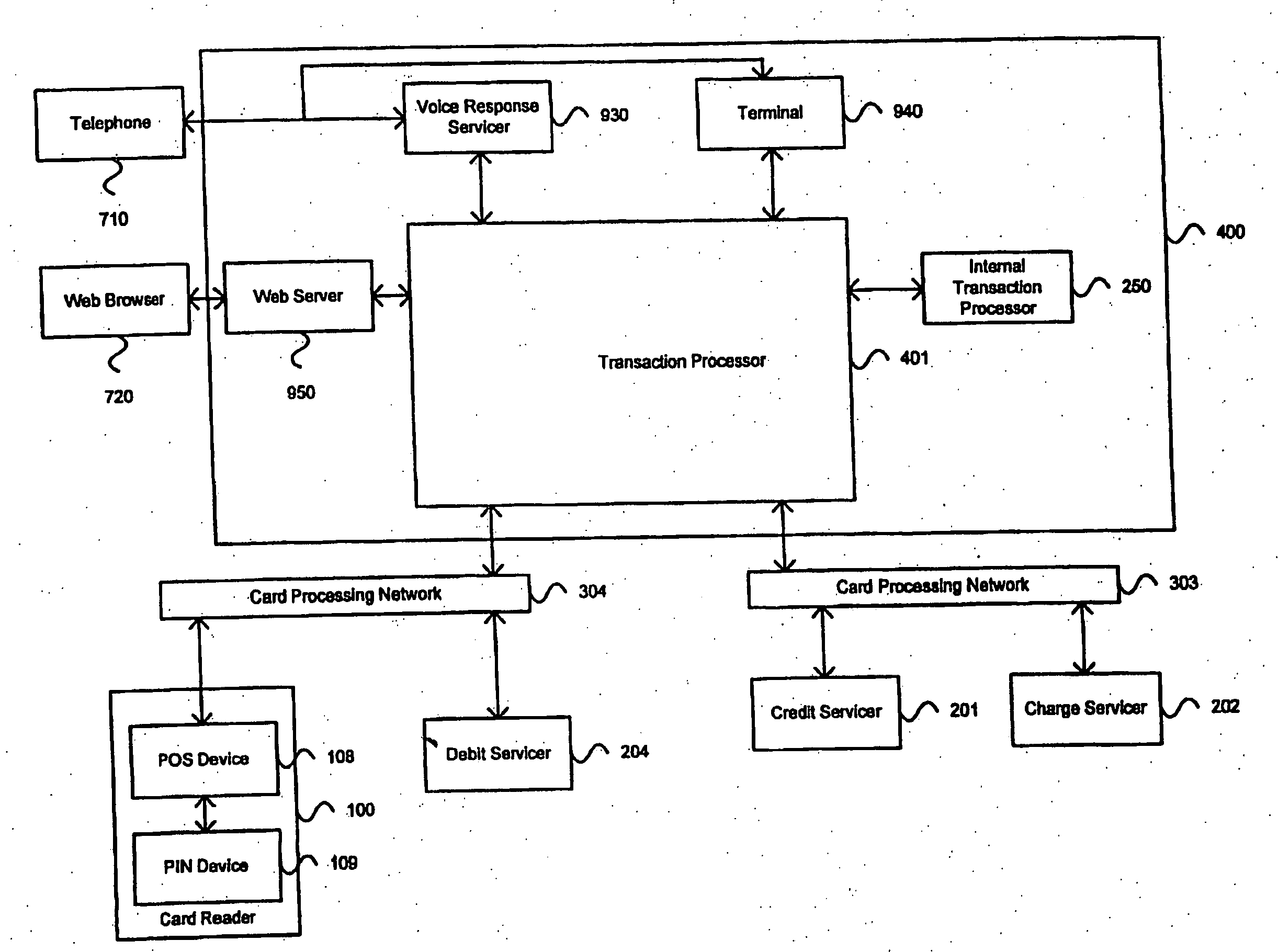

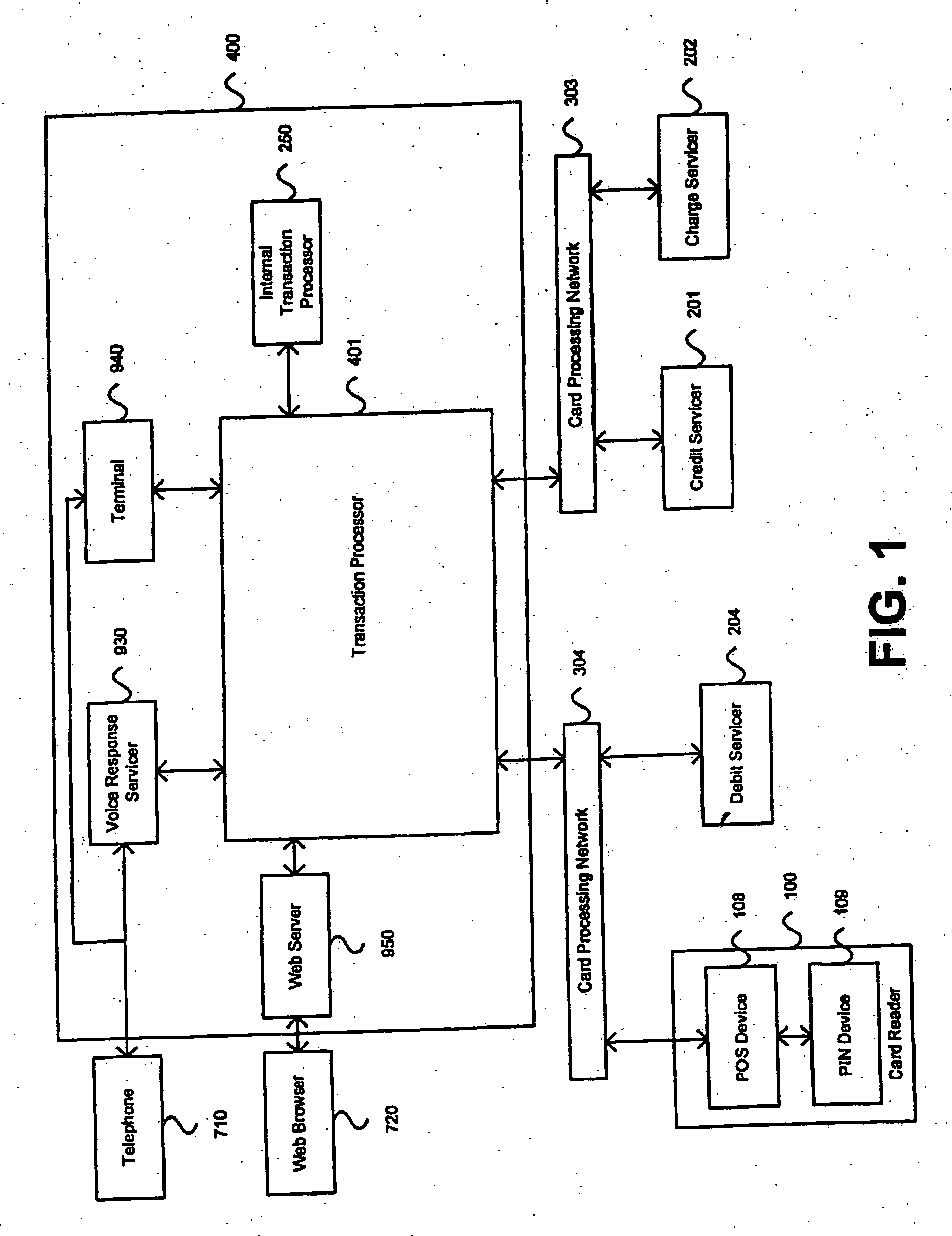

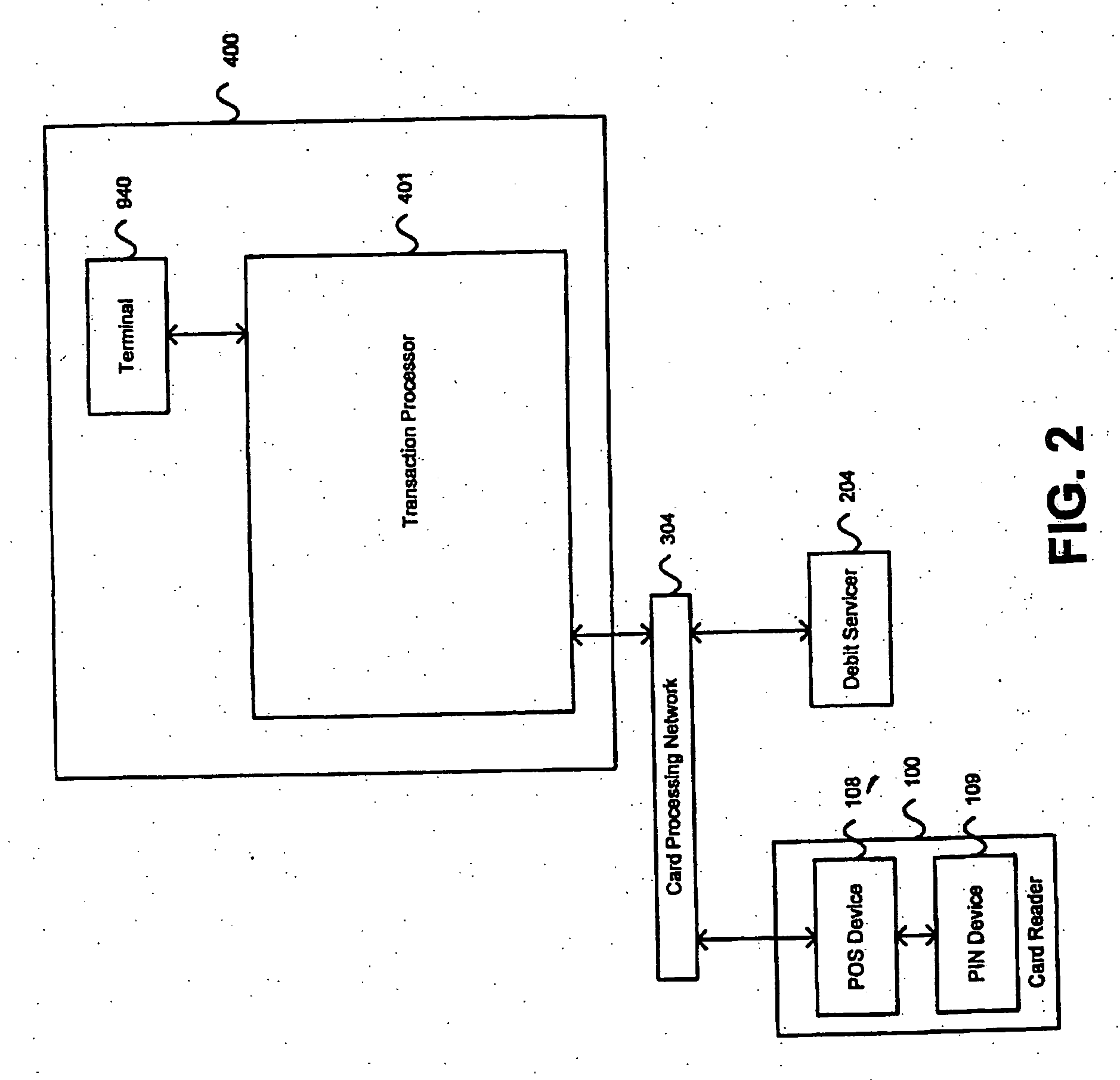

Contextual transaction token methods and systems

ActiveUS20150112870A1Electronic credentialsProtocol authorisationMachine learningTransaction processing system

Embodiments of the present invention are directed to methods, systems, apparatuses, and computer-readable mediums for generating and providing a transaction token that may provide contextual information associated with the token. Accordingly, the transaction token may provide any entities within a transaction processing system immediate information about the context in which the token was generated, how the token may be used, and any other information that may be pertinent to processing the token.

Owner:VISA INT SERVICE ASSOC

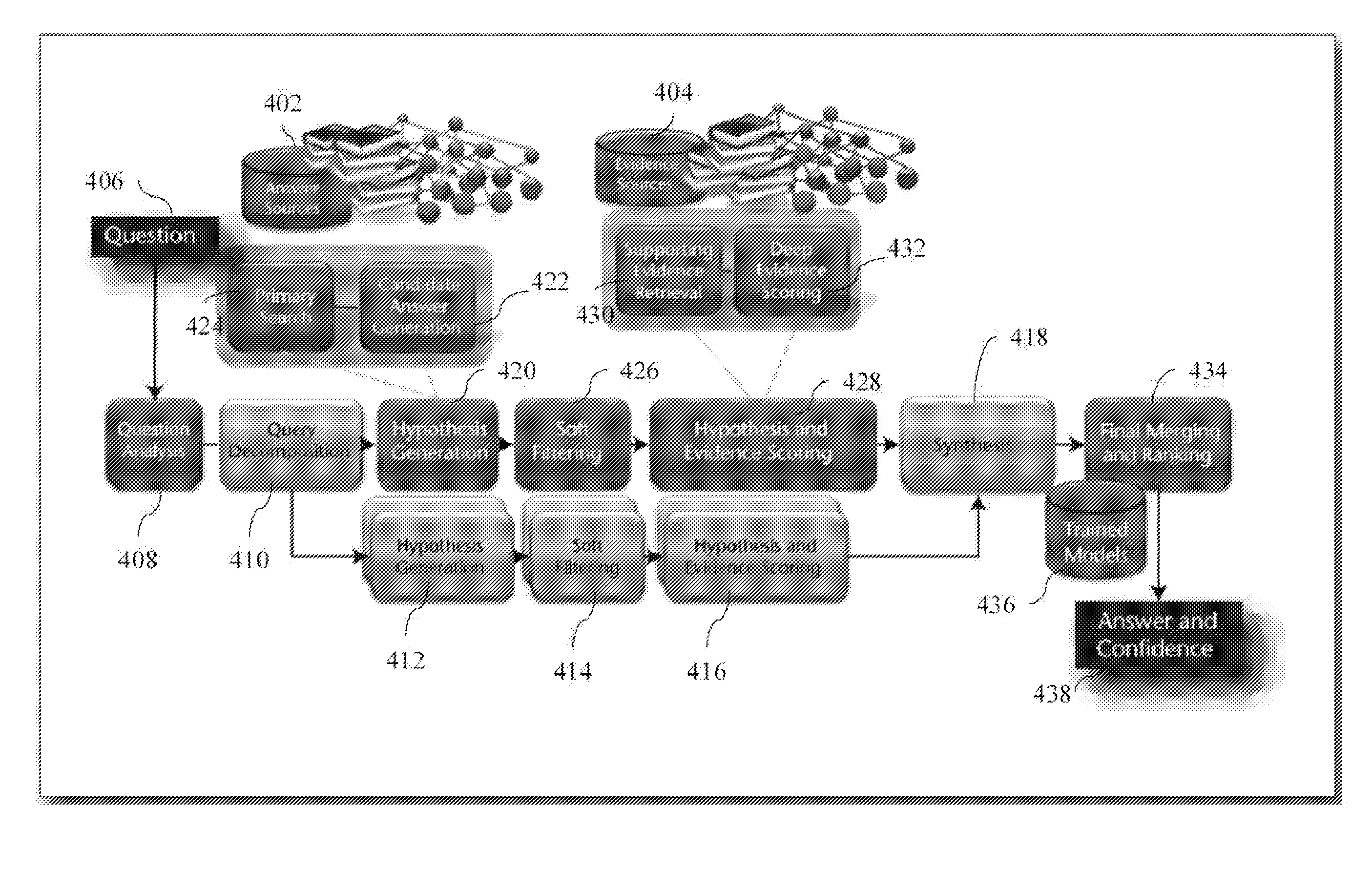

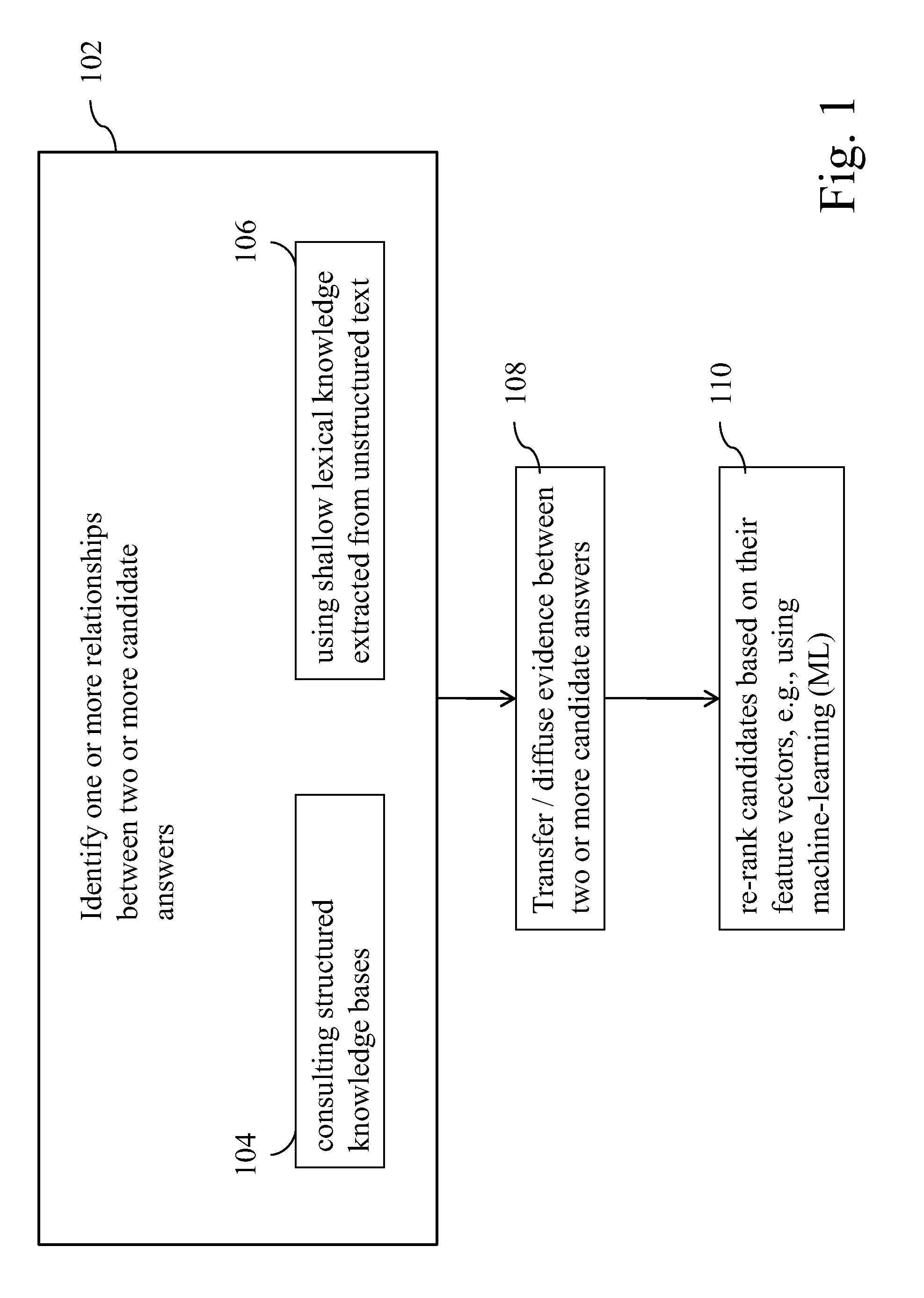

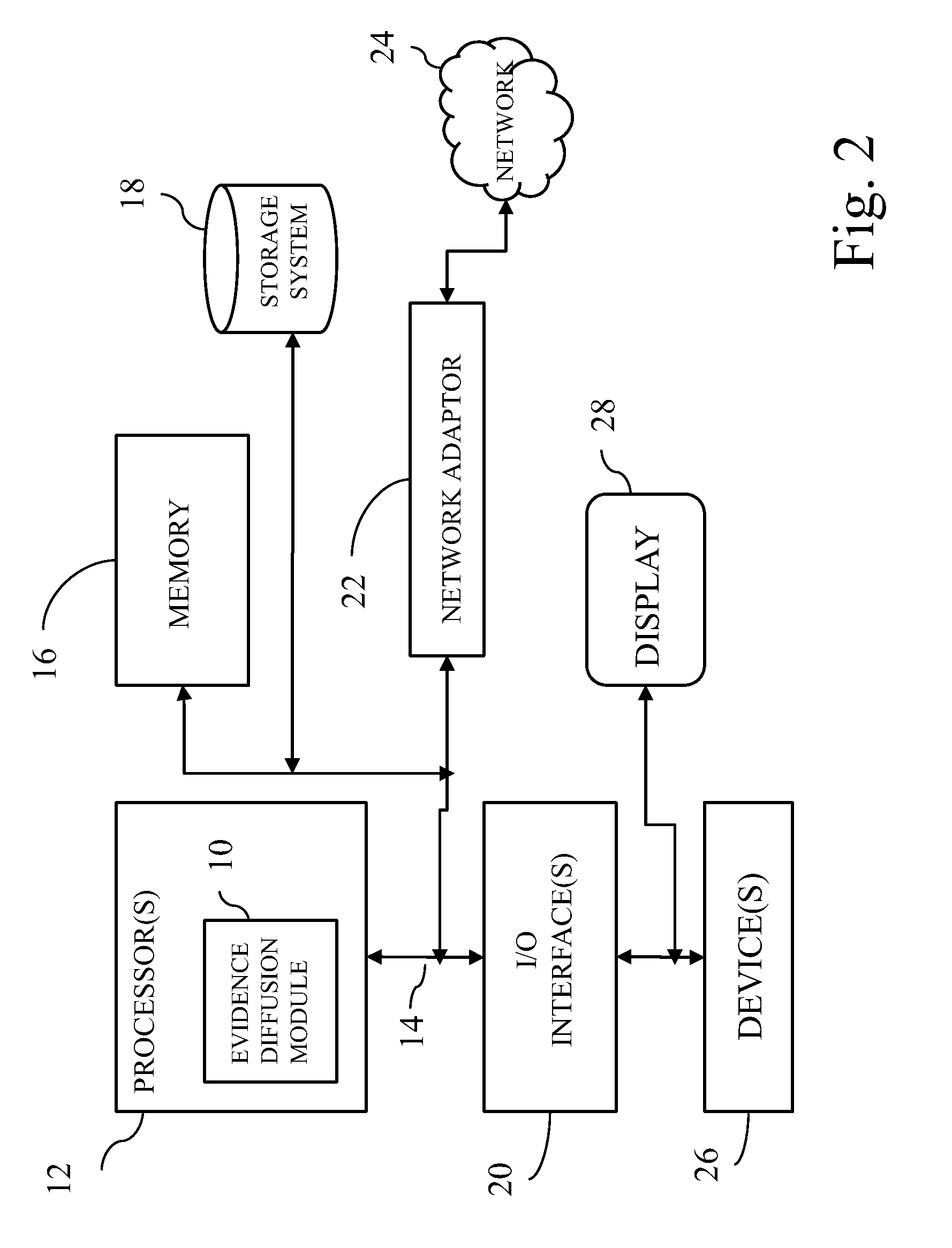

Evidence diffusion among candidate answers during question answering

ActiveUS20130018652A1Digital data information retrievalSpecial data processing applicationsQuestion answerMachine learning

Owner:INT BUSINESS MASCH CORP

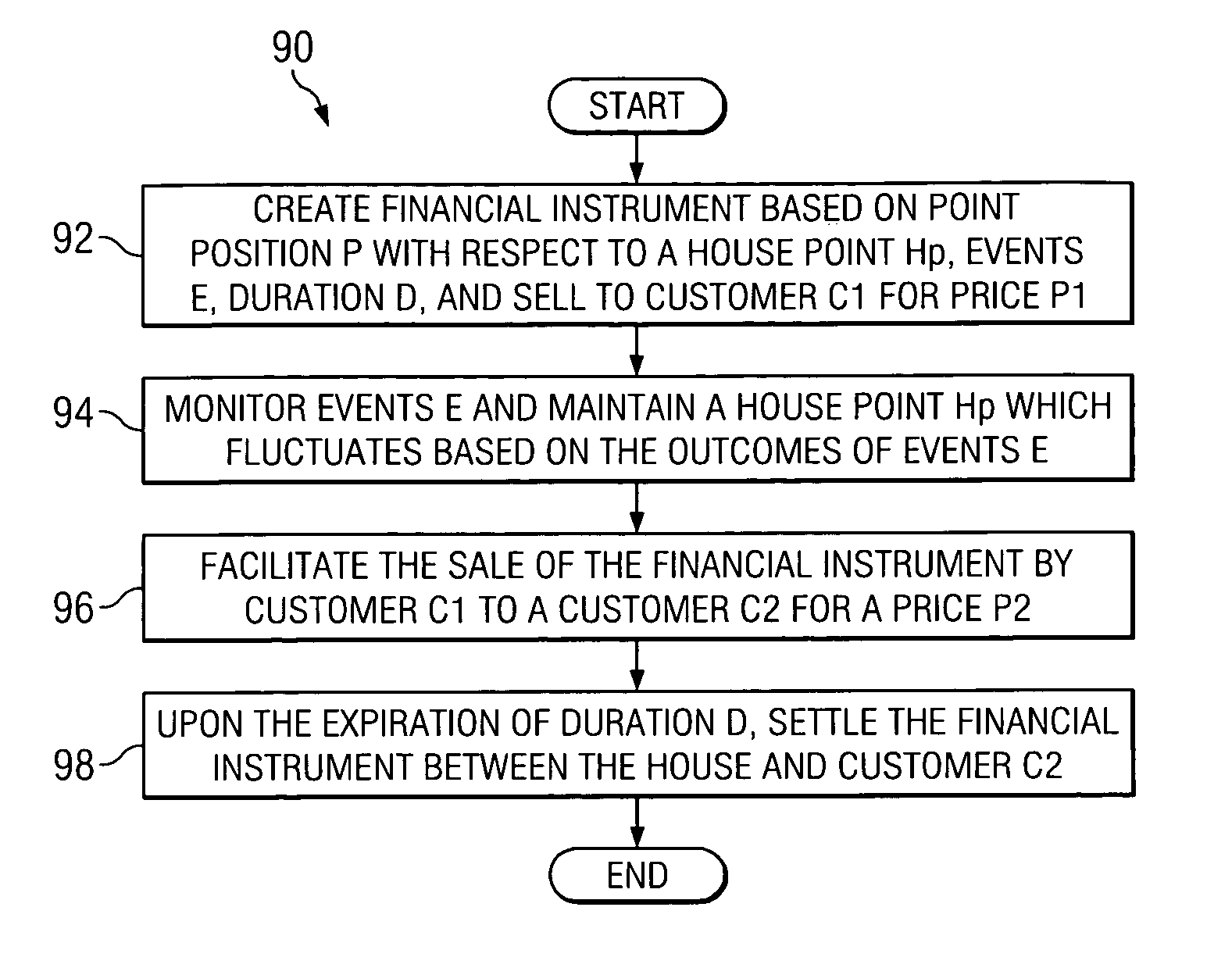

System and method for wagering based on the movement of financial markets

ActiveUS20050027643A1Reduce riskFacilitate communicationFinanceApparatus for meter-controlled dispensingMachine learning

A system for wagering comprises a memory and a processor. The memory stores a bet regarding a plurality of outcomes associated with financial market indicators. The bet comprises a first bet component indicating whether a value of a first financial market indicator will go up or go down in a first predetermined period of time, and a second bet component indicating whether a value of a second financial market indicator will go up or go down in a second predetermined period of time. The processor is coupled to the memory and is operable to determine an outcome of the first bet component, the second bet component, and the overall bet.

Owner:CFPH LLC

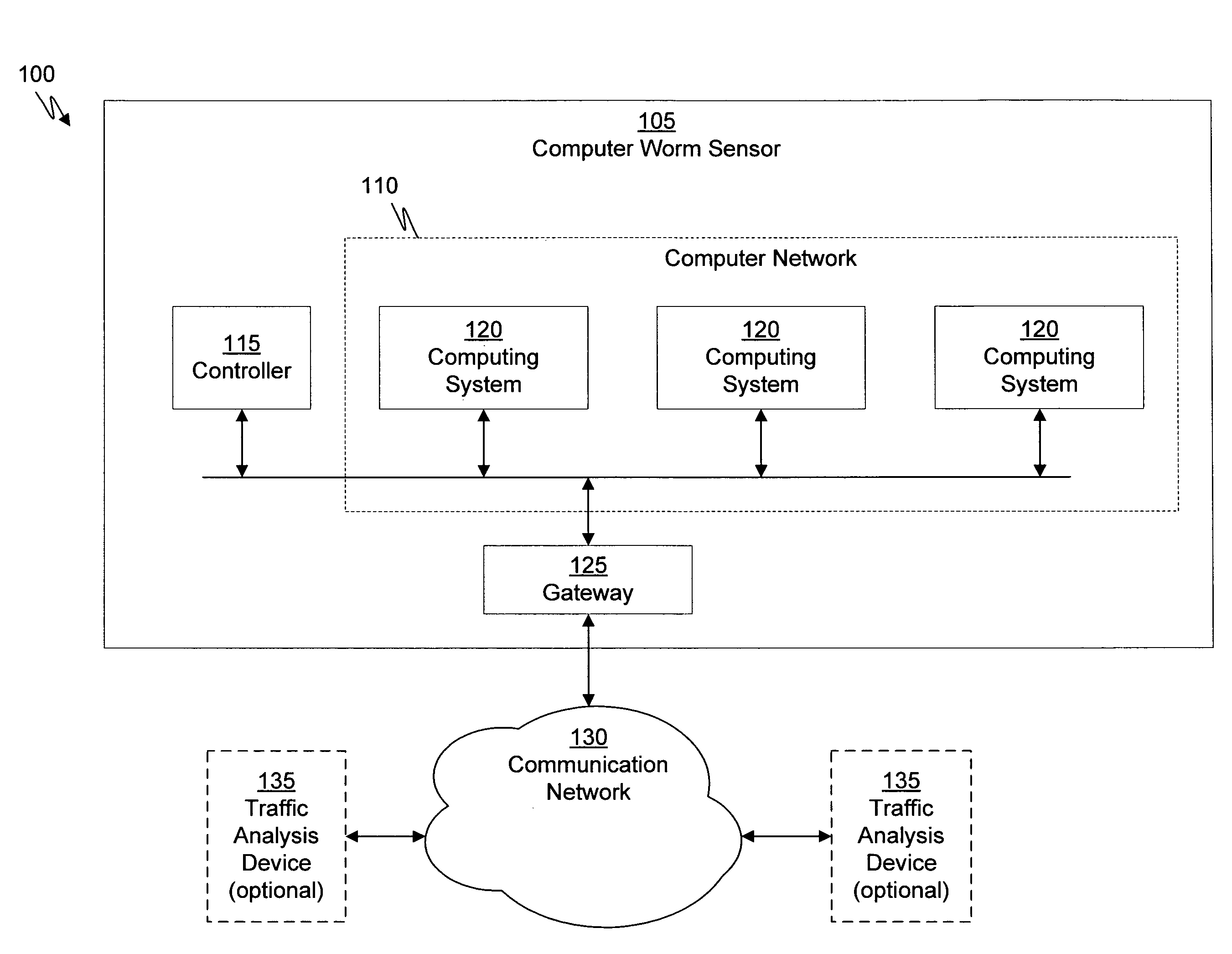

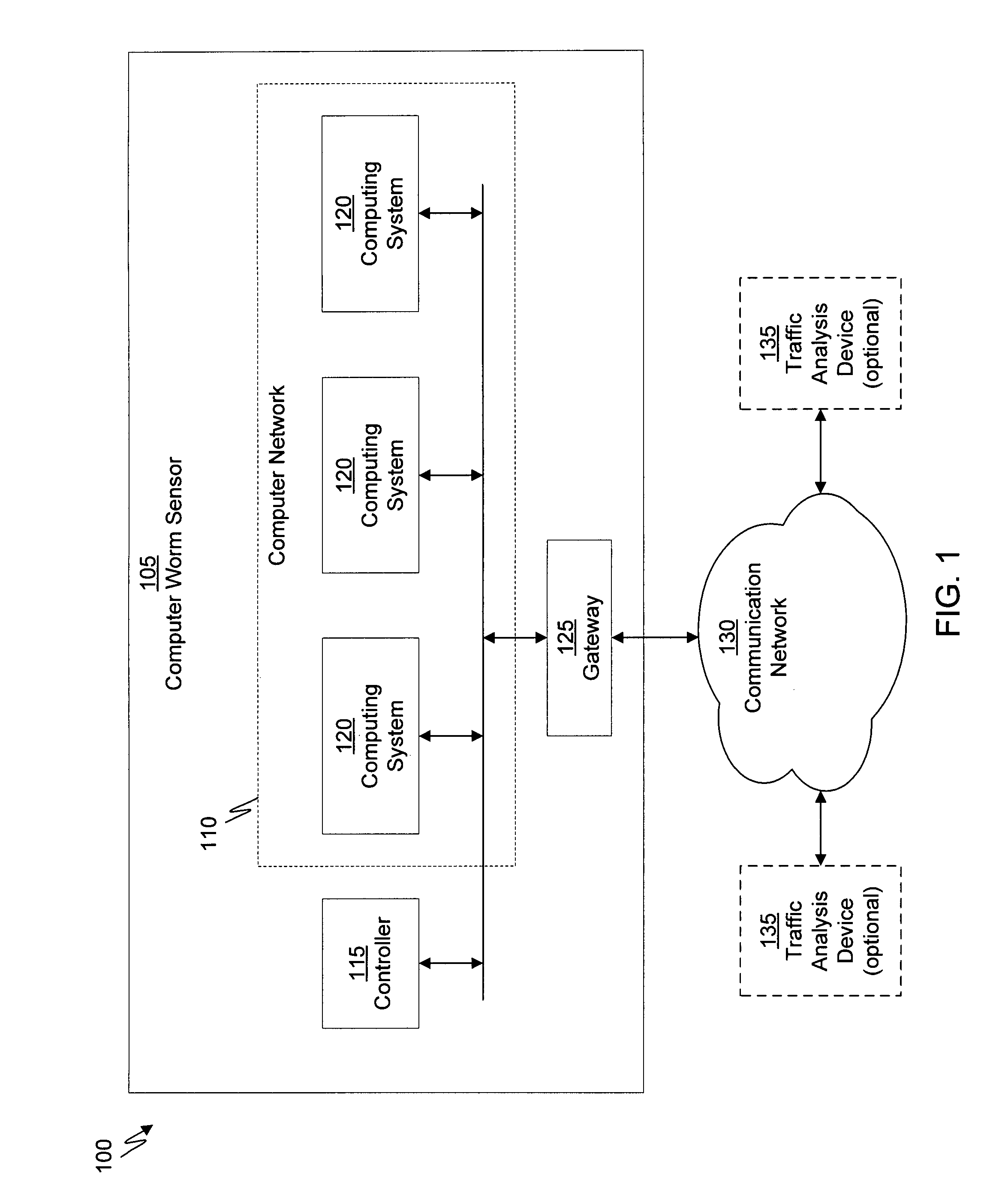

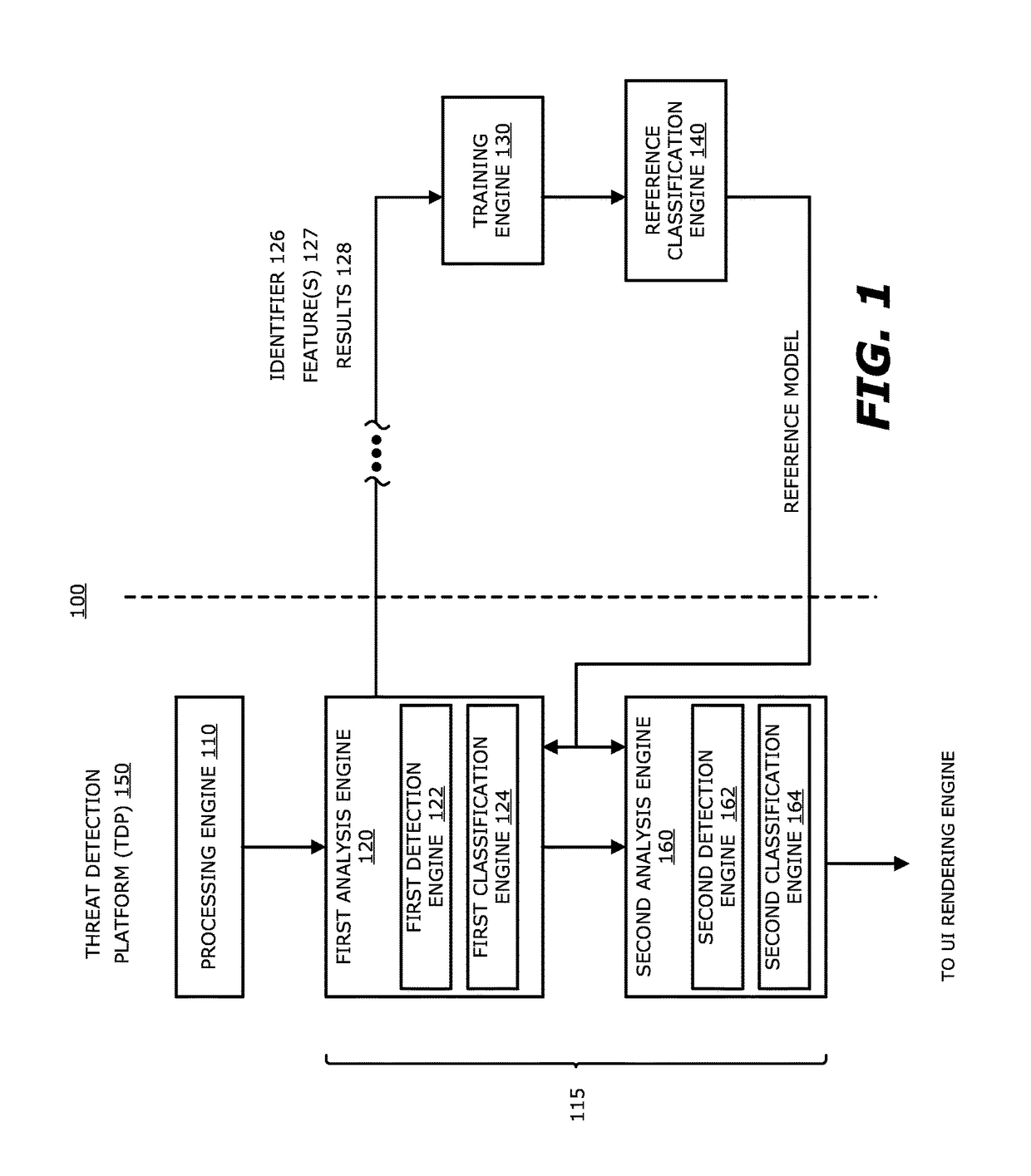

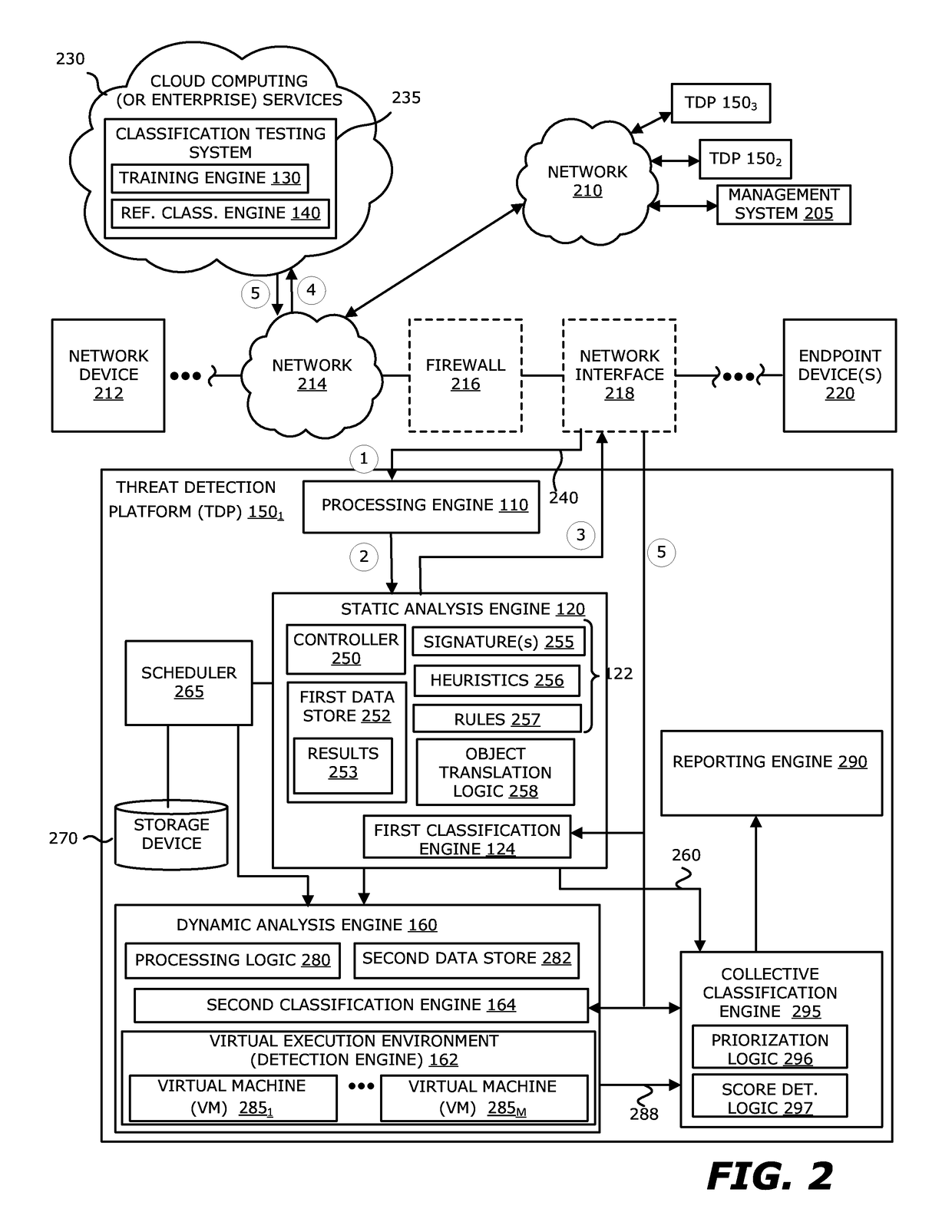

Systems and methods for malware attack detection and identification

Exemplary systems and methods for malware attack detection and identification are provided. A malware detection and identification system can comprise a controller. The controller can comprise an analysis environment configured to transmit network data to a virtual machine, flag input values associated with the network data from untrusted sources, monitor the flagged input values within the virtual machine, identify an outcome of one or more instructions that manipulate the flagged input values, and determine if the outcome of the one or more instructions comprise an unauthorized activity.

Owner:FIREEYE SECURITY HLDG US LLC

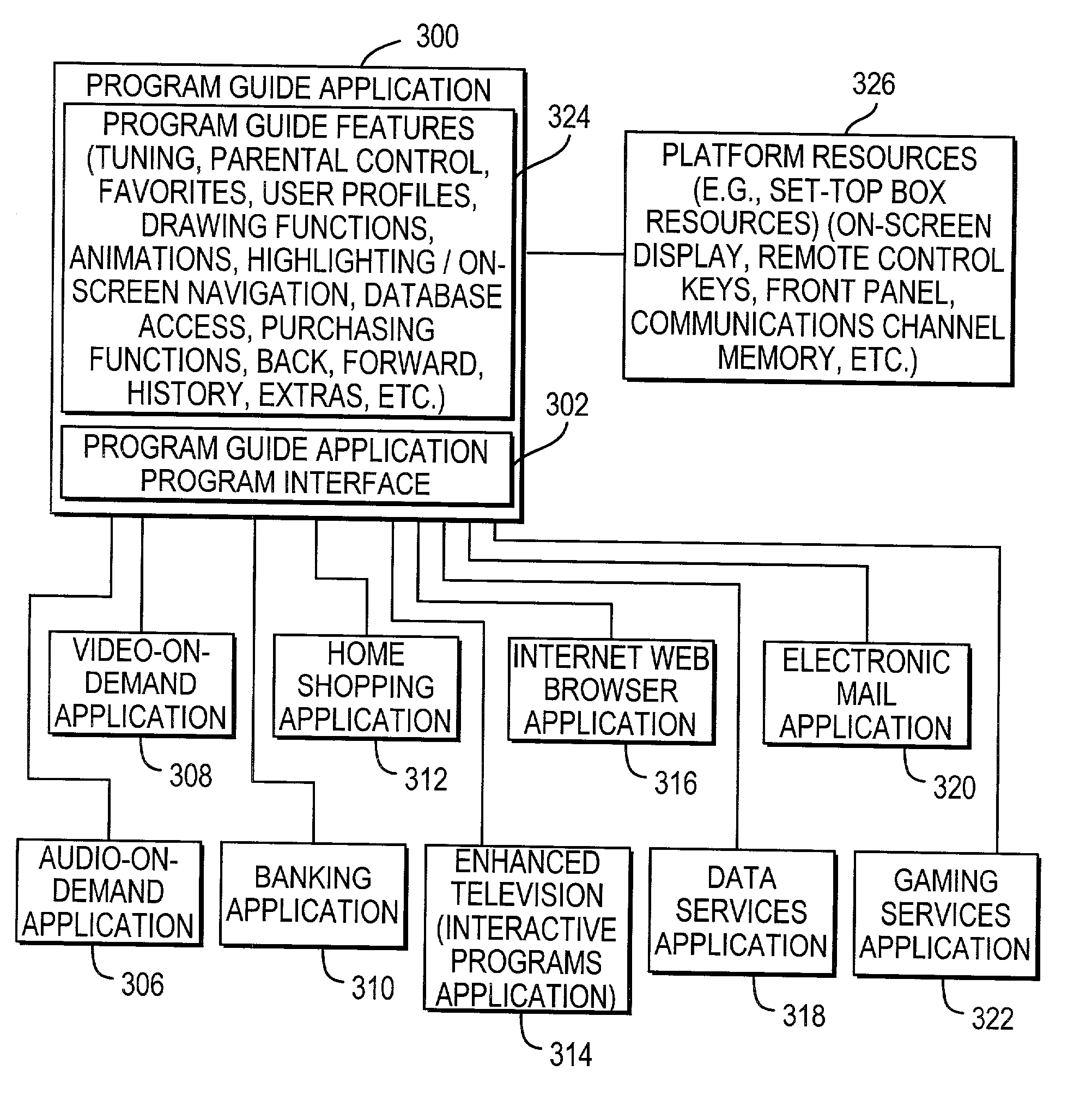

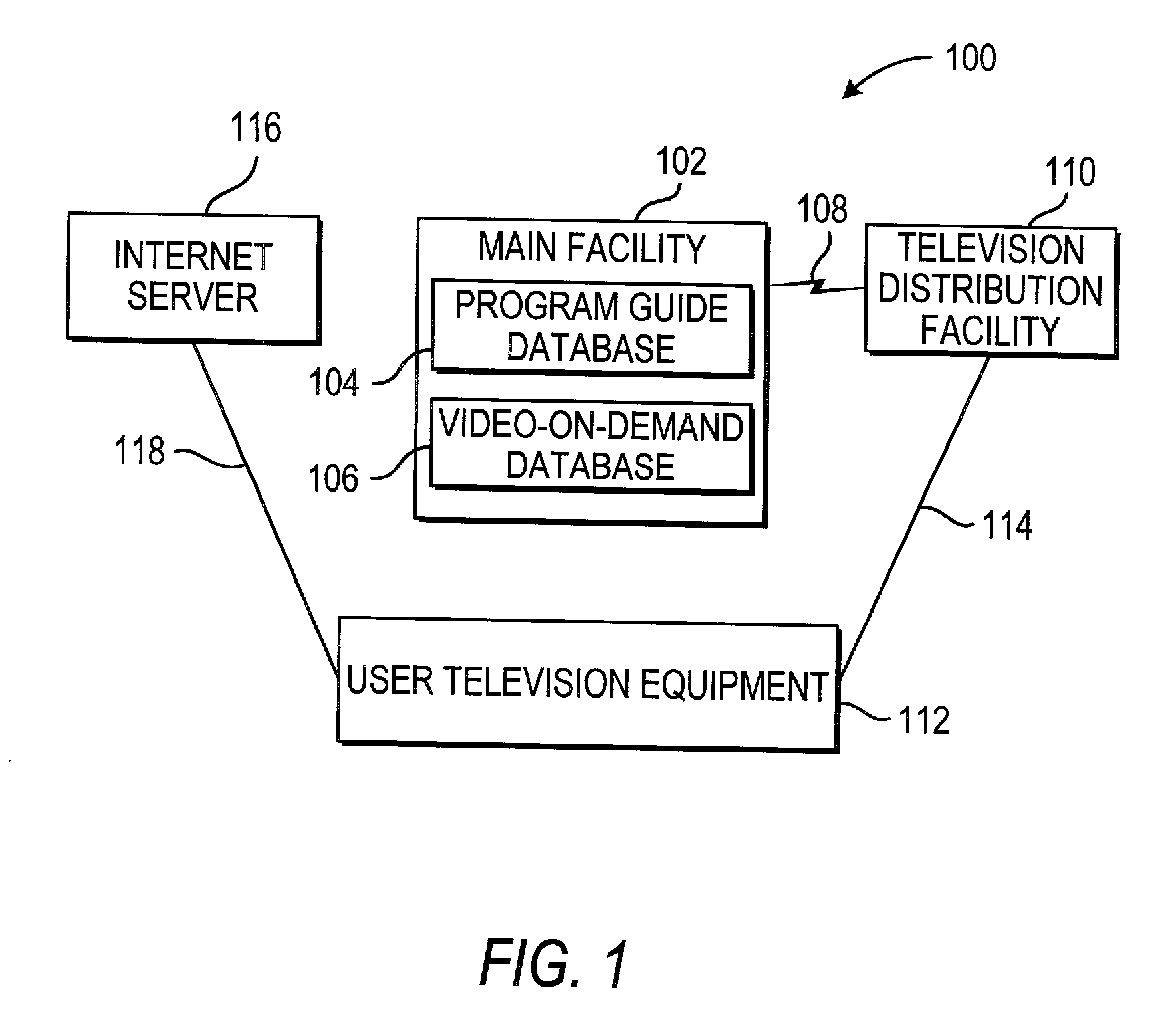

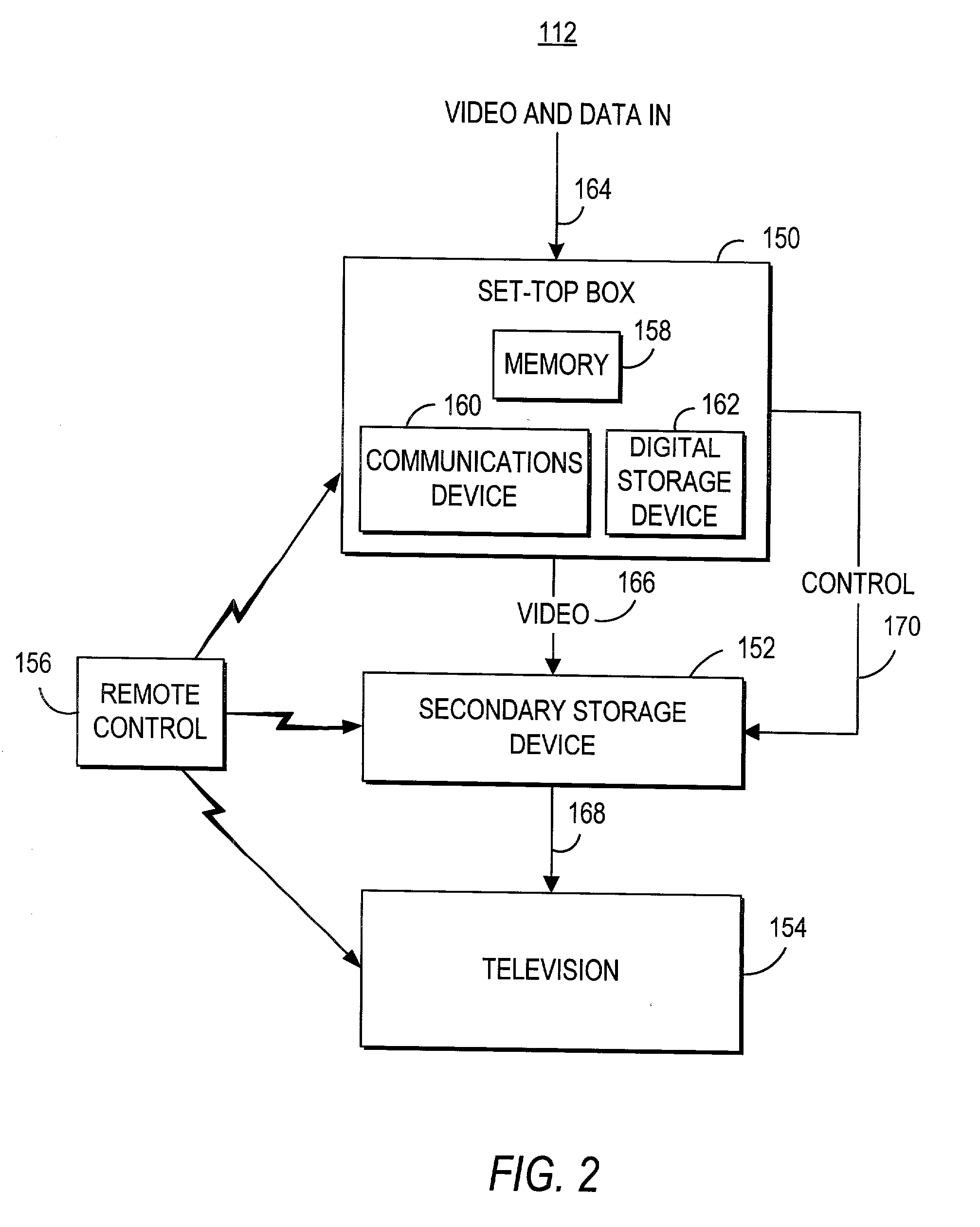

Features for use with advanced set-top applications on interactive television systems

InactiveUS20050235319A1Television system detailsAnalogue secracy/subscription systemsTelevision systemInteractive television

Advanced features for interactive television applications are described, including a back feature, a forward feature, a history feature, a go to feature, an extras feature, a reminder feature, a favorites feature, a parental control feature, and a search feature. Features may be inter-resource. Support for multiple data paths, Internet access, interactive services, and user profiles are also described.

Owner:UNITED VIDEO PROPERTIES

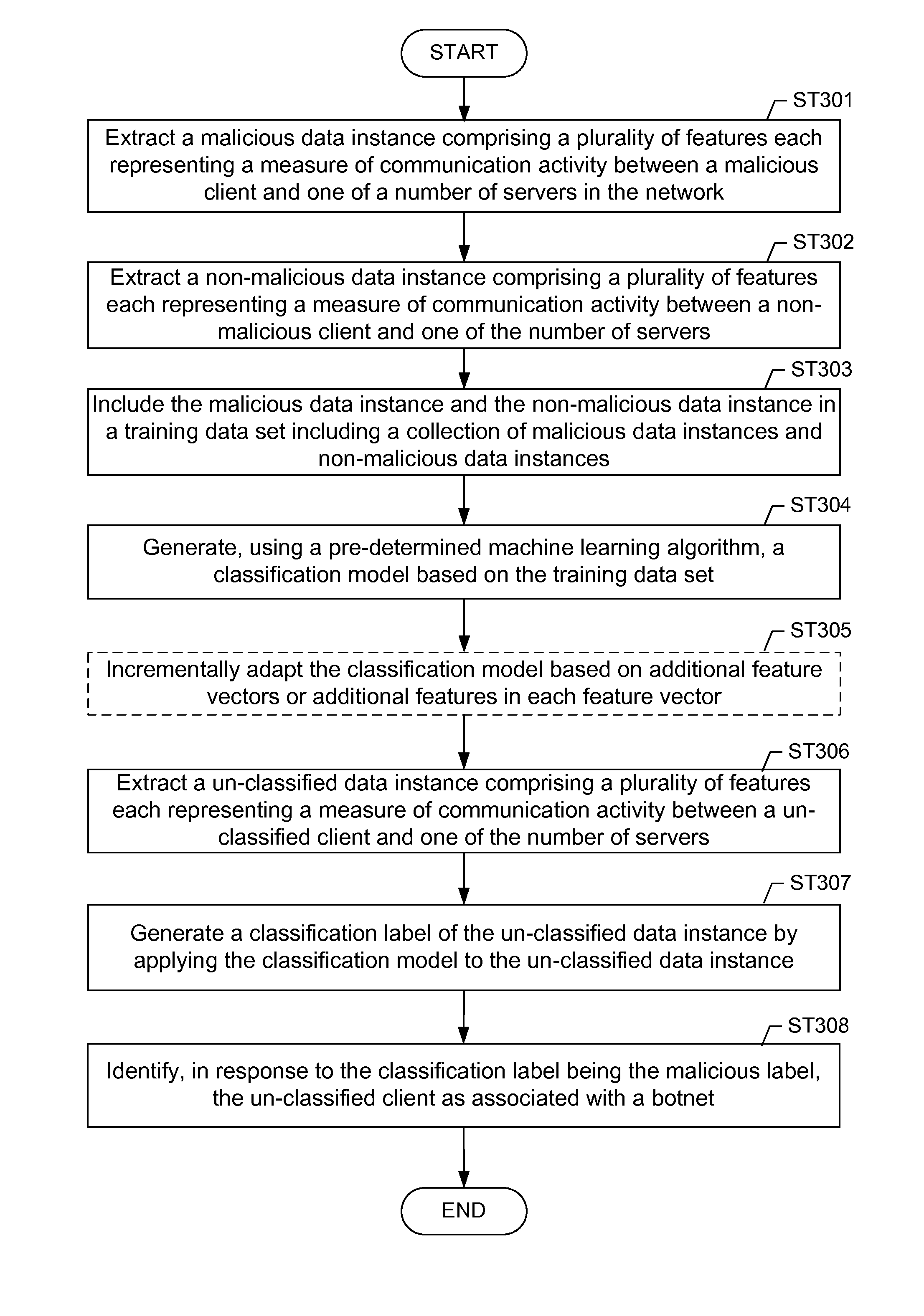

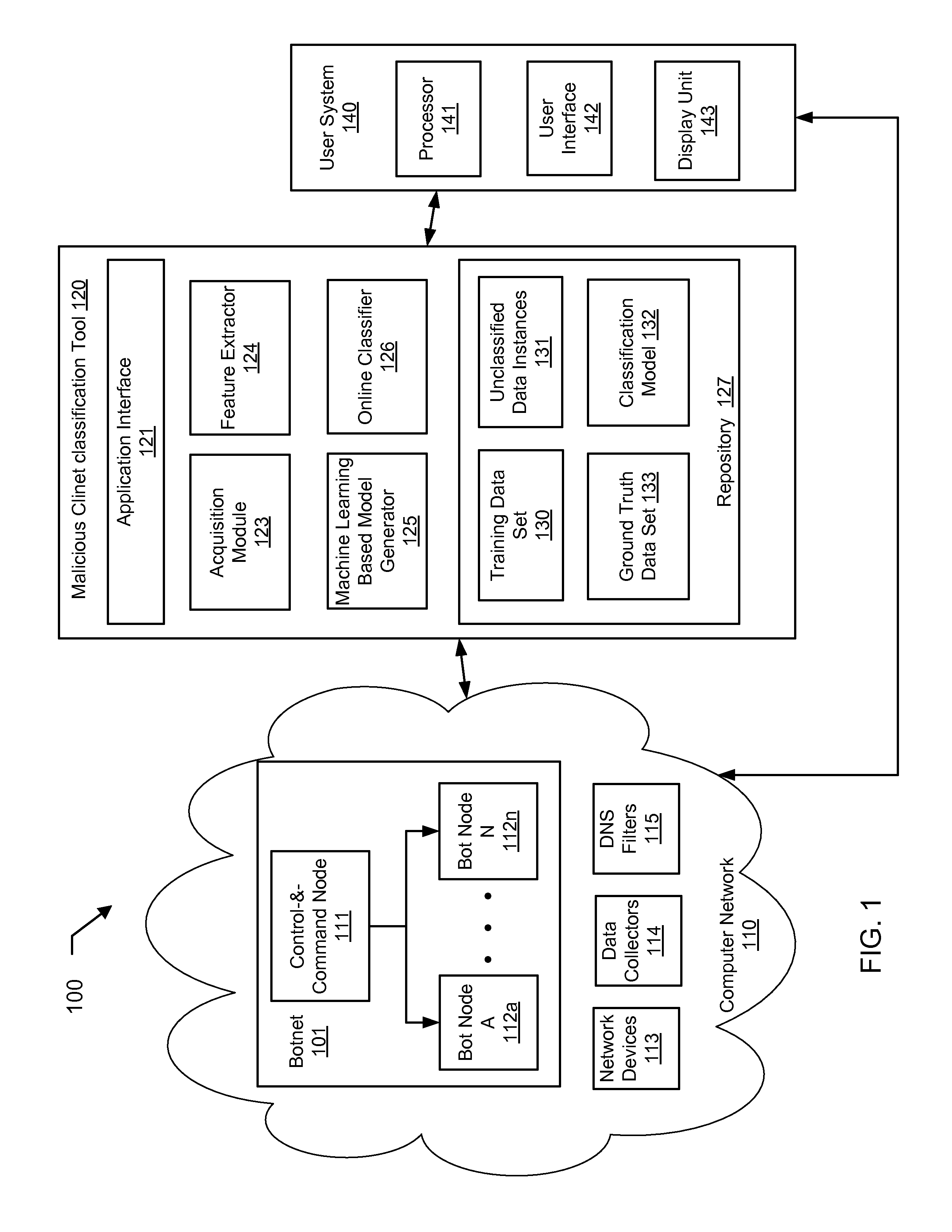

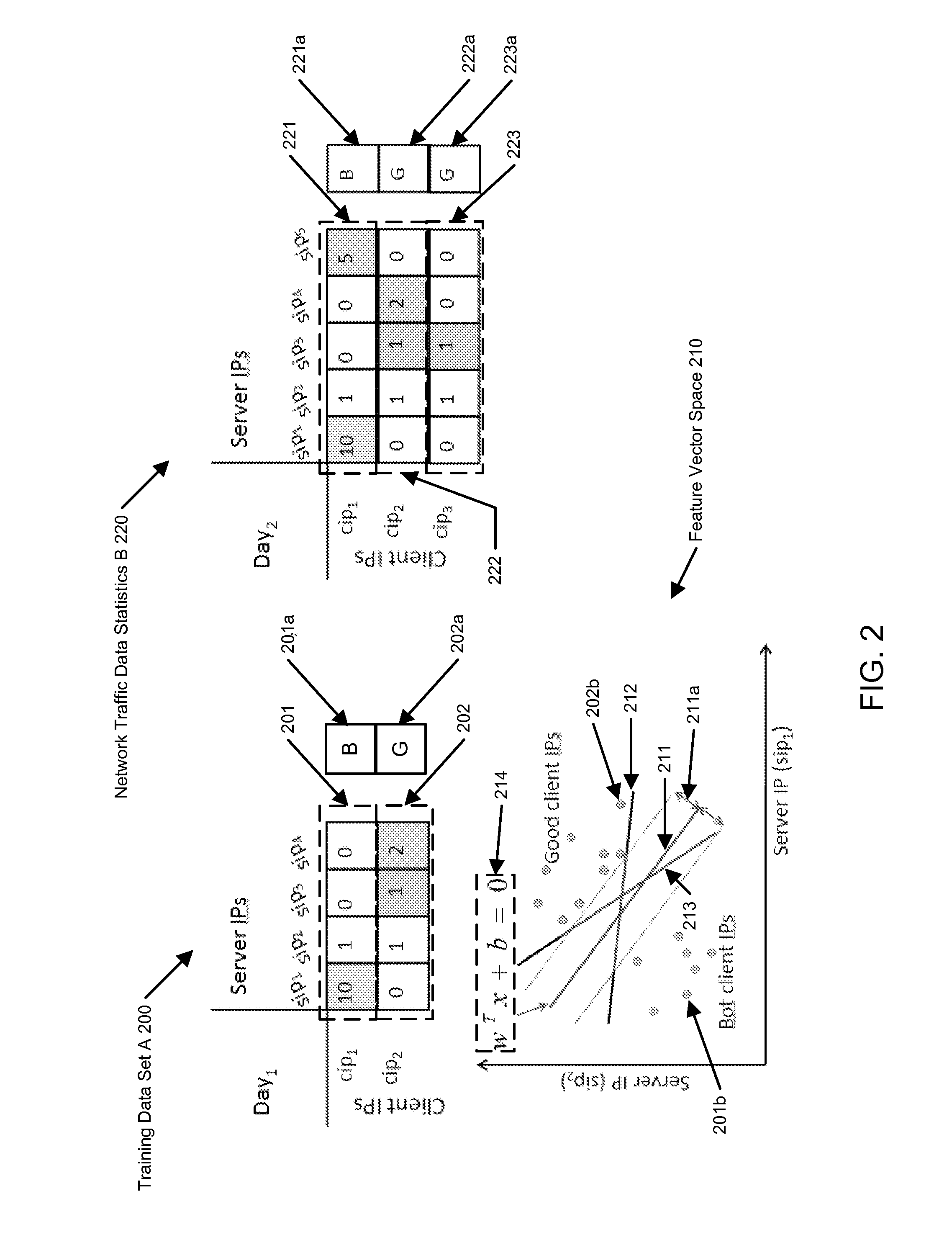

Machine learning based botnet detection with dynamic adaptation

Embodiments of the invention address the problem of detecting bots in network traffic based on a classification model learned during a training phase using machine learning algorithms based on features extracted from network data associated with either known malicious or known non-malicious client and applying the learned classification model to features extracted in real-time from current network data. The features represent communication activities between the known malicious or known non-malicious client and a number of servers in the network.

Owner:THE BOEING CO

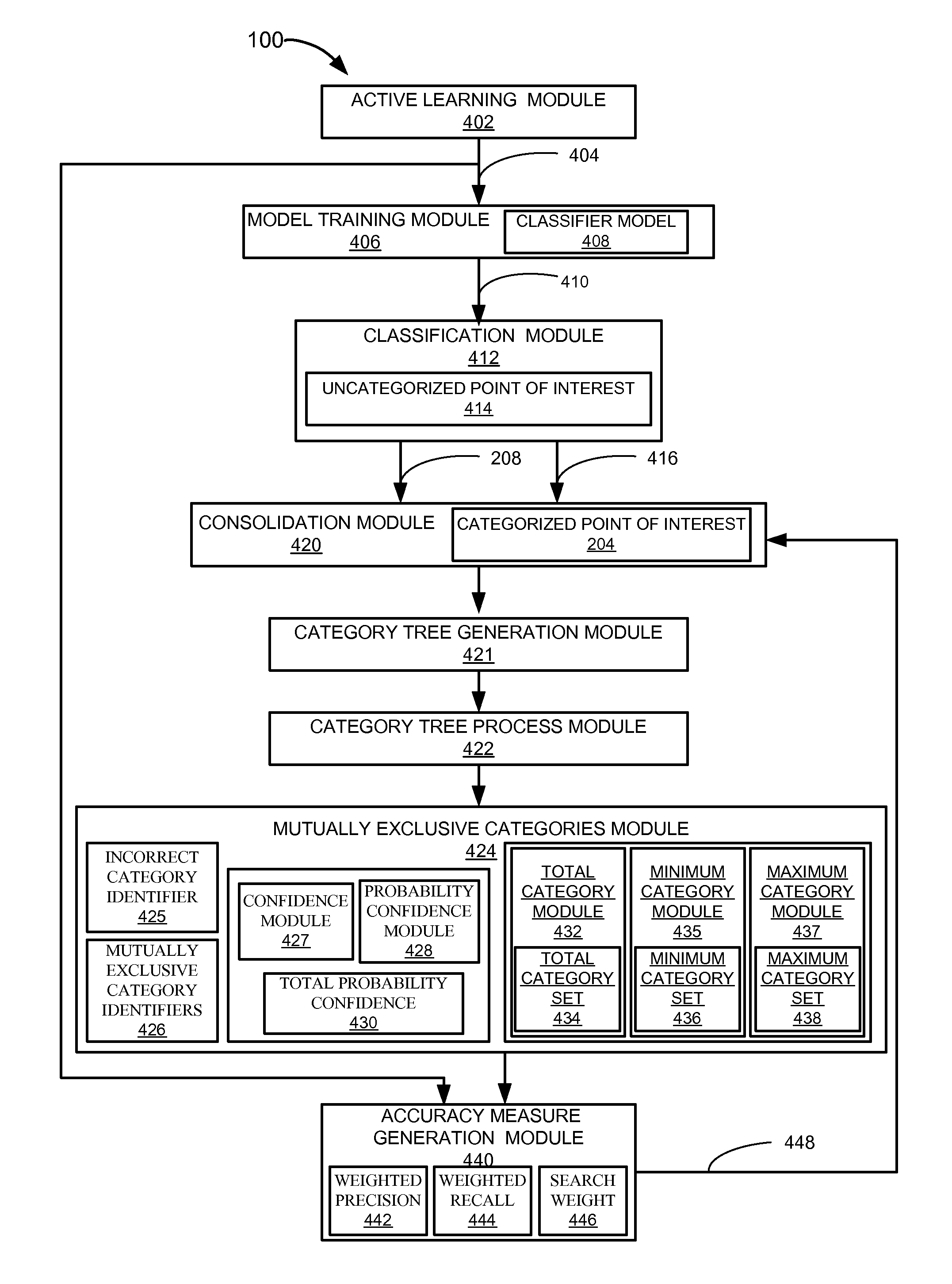

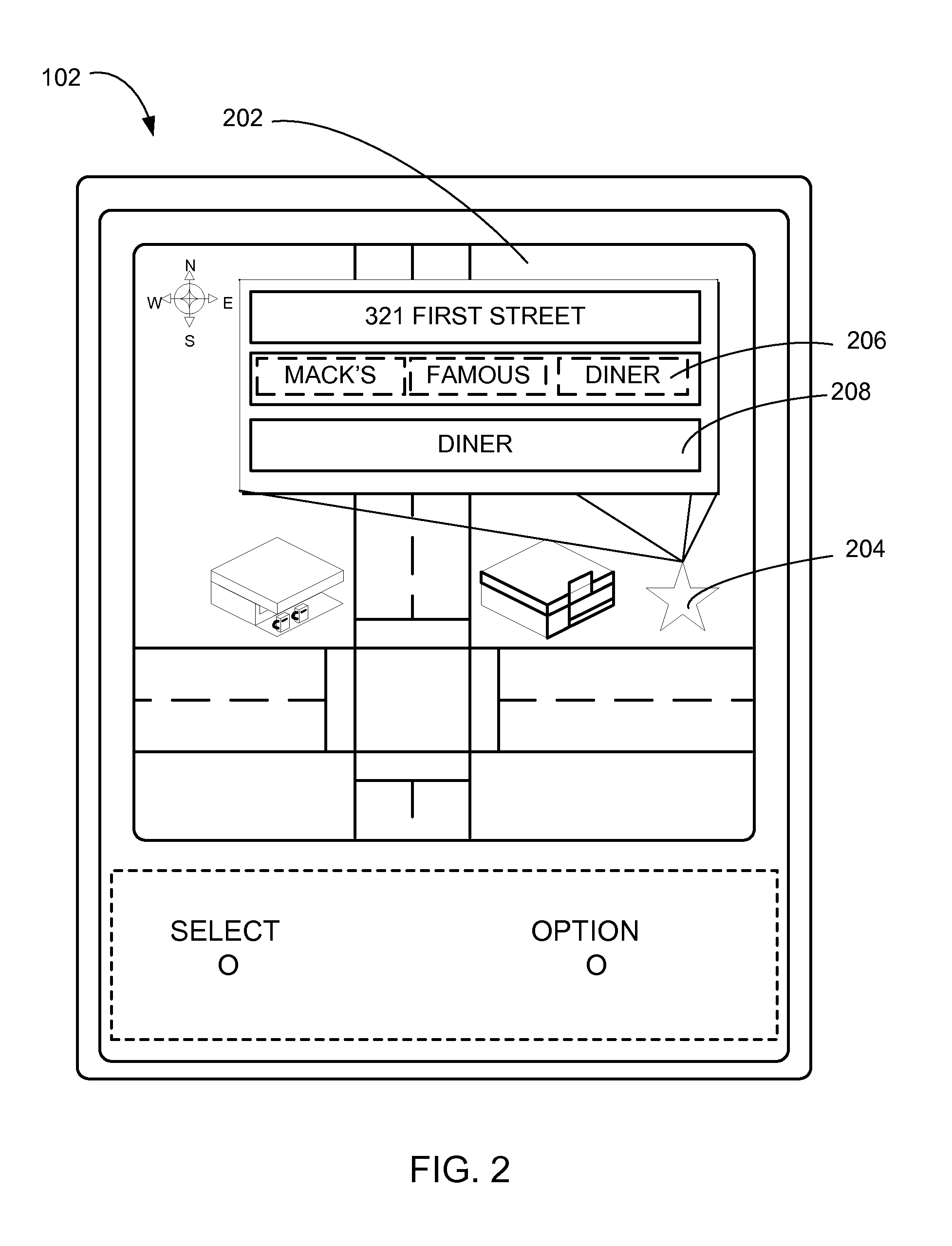

Navigation system with point of interest classification mechanism and method of operation thereof

A method of operation of a navigation system includes: generating a training data from a randomly sampled uncategorized point of interest; generating a trained classifier model by training a classifier model using the training data; generating a category identifier, a confidence score, or a combination thereof for an uncategorized point of interest using the trained classifier model; generating a categorized point of interest by assigning the category identifier to the uncategorized point of interest; calculating a weighted confidence score based on a weighted F-measure for the category identifier, a pair of the category identifier and the confidence score; and consolidating the categorized point of interest based on the weighted confidence score for the category identifier being meeting or exceeding a threshold for displaying on a device.

Owner:TELENAV INC

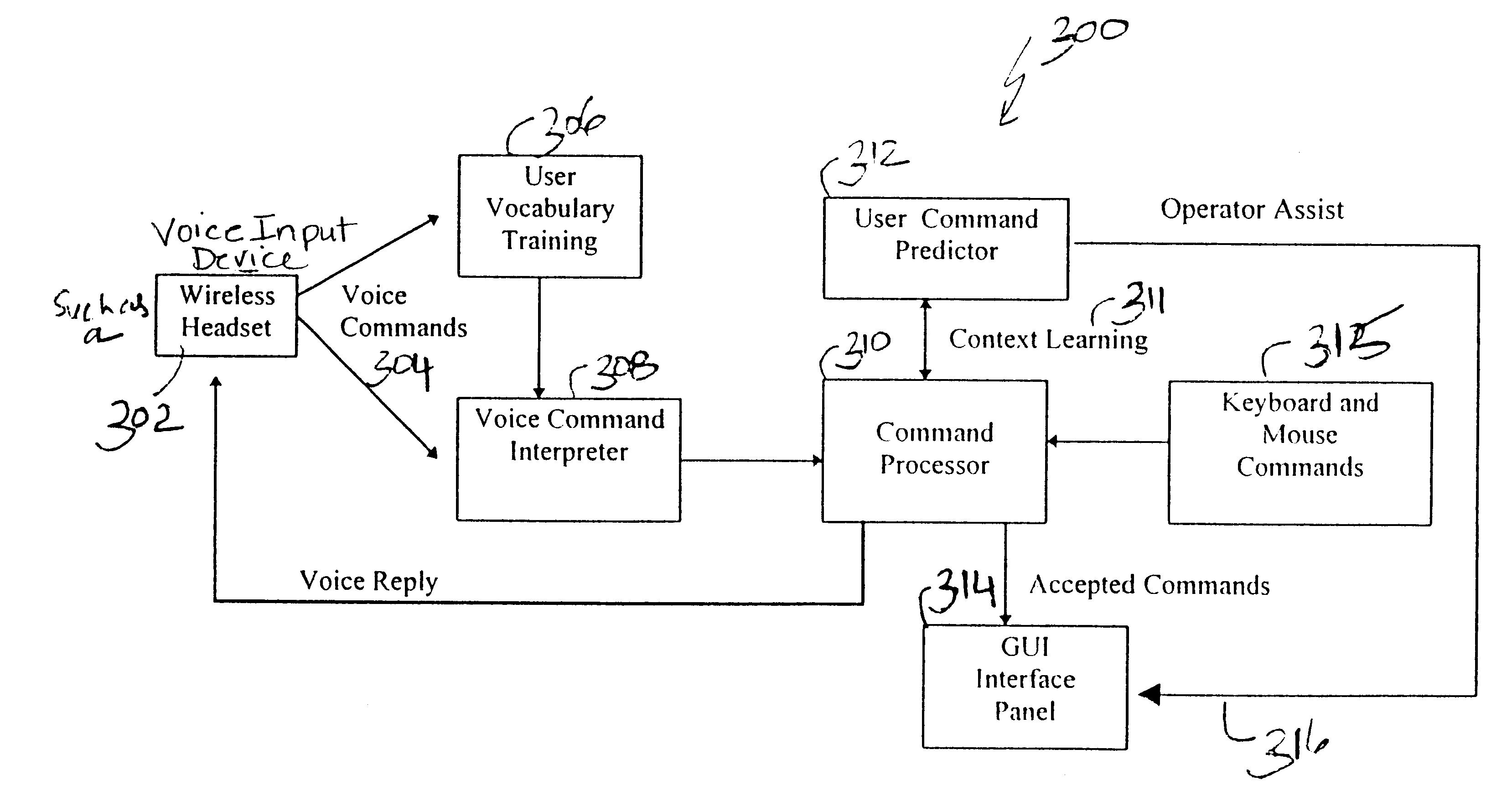

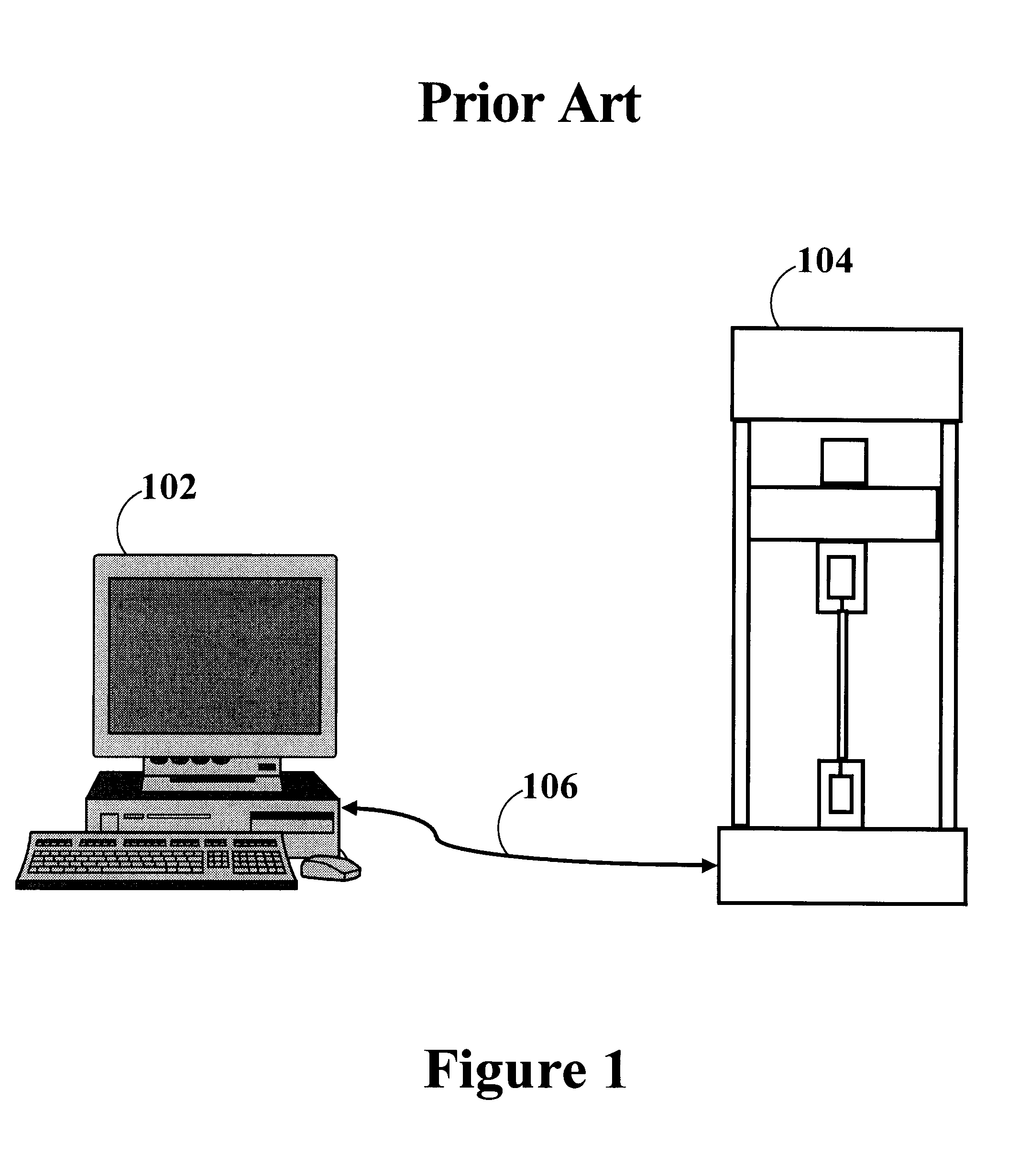

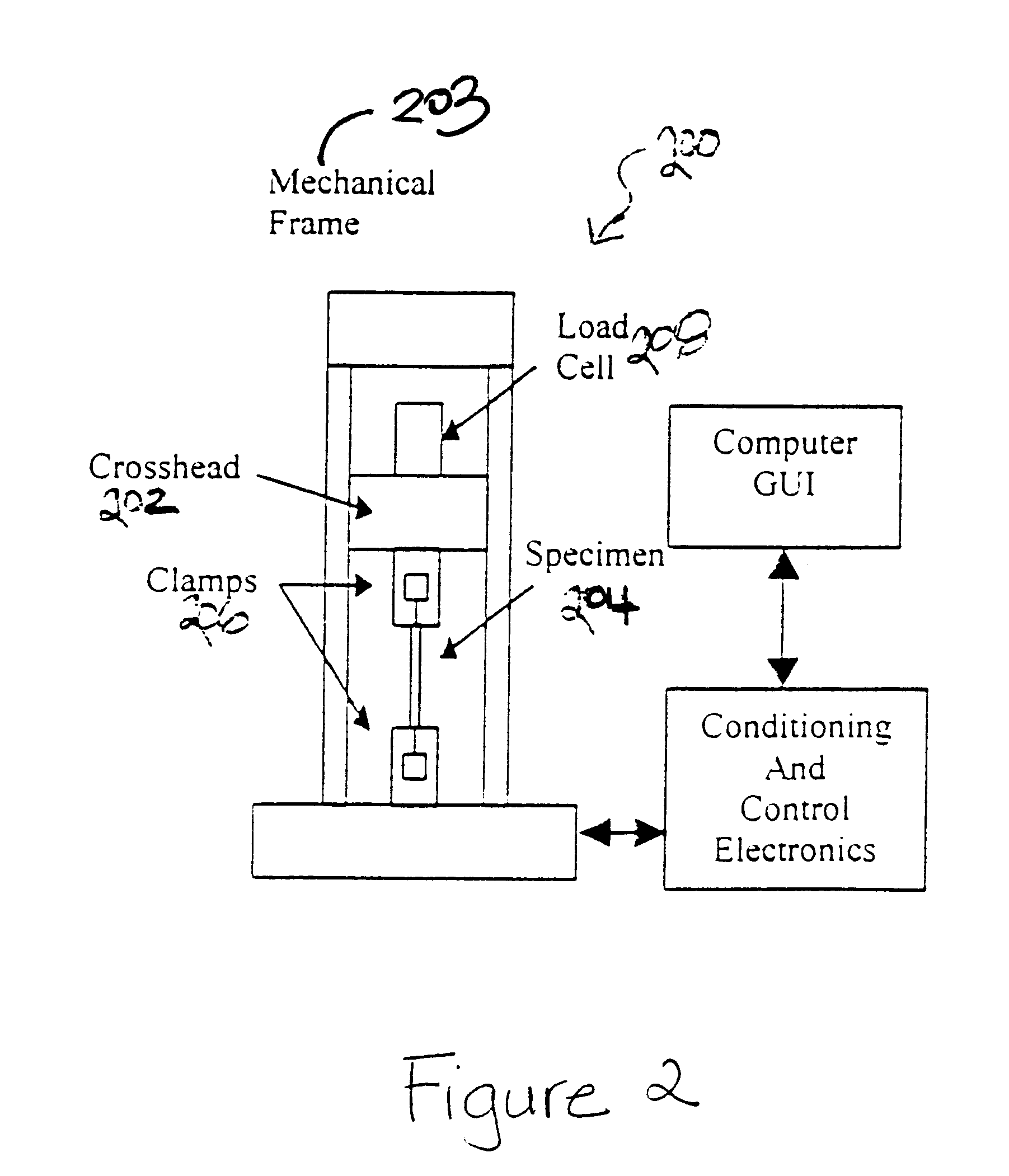

Voice actuation with contextual learning for intelligent machine control

InactiveUS6895380B2Reduce probabilityImprove robustnessFlow propertiesMeasurement arrangements for variableHuman–computer interactionTensile testing

An interactive voice actuated control system for a testing machine such as a tensile testing machine is described. Voice commands are passed through a user-command predictor and integrated with a graphical user interface control panel to allow hands-free operation. The user-command predictor learns operator command patterns on-line and predicts the most likely next action. It assists less experienced operators by recommending the next command, and it adds robustness to the voice command interpreter by verbally asking the operator to repeat unlikely commanded actions. The voice actuated control system applies to industrial machines whose normal operation is characterized by a nonrandom series of commands.

Owner:ELECTRO STANDARDS LAB

Method, transaction card or identification system for transaction network comprising proprietary card network, eft, ach, or atm, and global account for end user automatic or manual presetting or adjustment of multiple account balance payoff, billing cycles, budget control and overdraft or fraud protection for at least one transaction debit using at least two related financial accounts to maximize both end user control and global account issuer fees from end users and merchants, including account, transaction and interchange fees

InactiveUS20070168265A1Increase flexibilityEasy maintenanceComplete banking machinesFinanceCredit cardFinancial transaction

The present invention provides methods, systems and transaction cards or identification systems, using transaction network comprising proprietary card network, EFT, ACH, or ATM, for end user management of a global financial account by manual or automatic prepaying, prepaying, paying or unpaying, debiting or crediting, or readjustment or presetting, using parameters relating to portions of paid or unpaid financial transactions or account balance amounts in multiple credit, cash or other existing, or end user created, financial accounts or sub-accounts in said global financial account that is optionally subject to financial account issuer transaction or readjustment fees from end users and merchants, including optional use for financial transactions as a credit transaction card requiring merchant credit card interchange or other fees, and optional end user fees, as additional revenue to the global account issuer.

Owner:ROSENBERGER RONALD JOHN

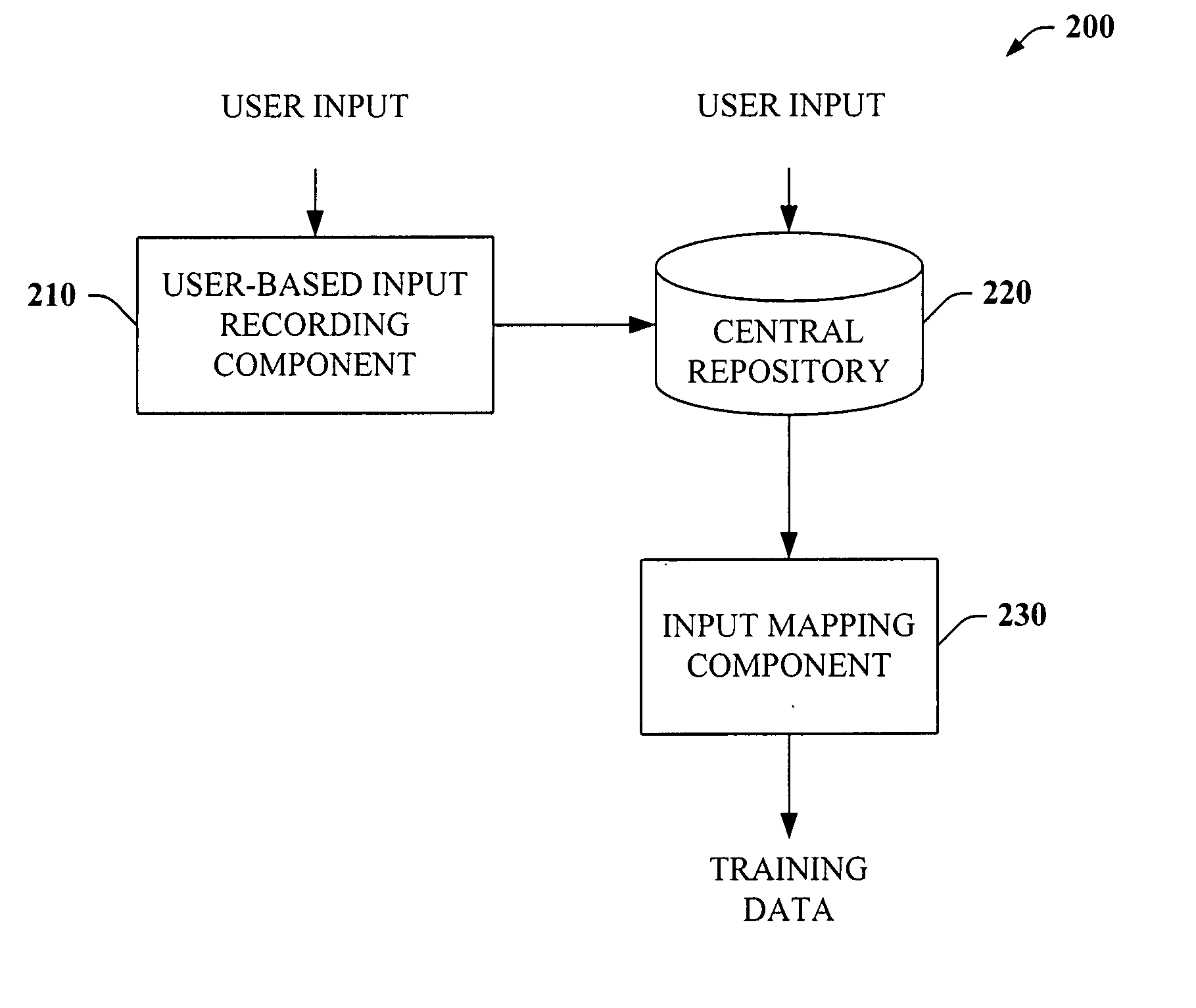

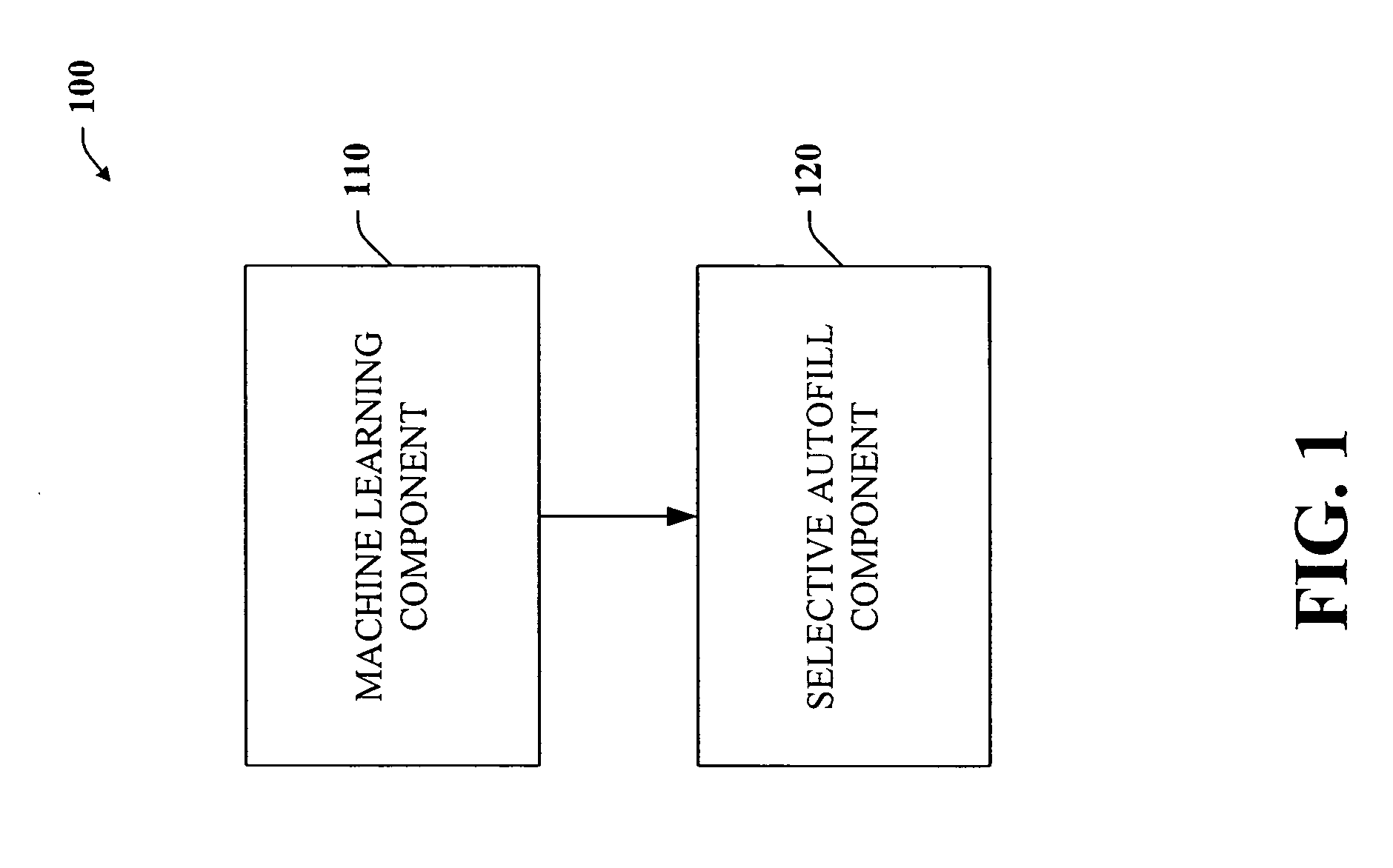

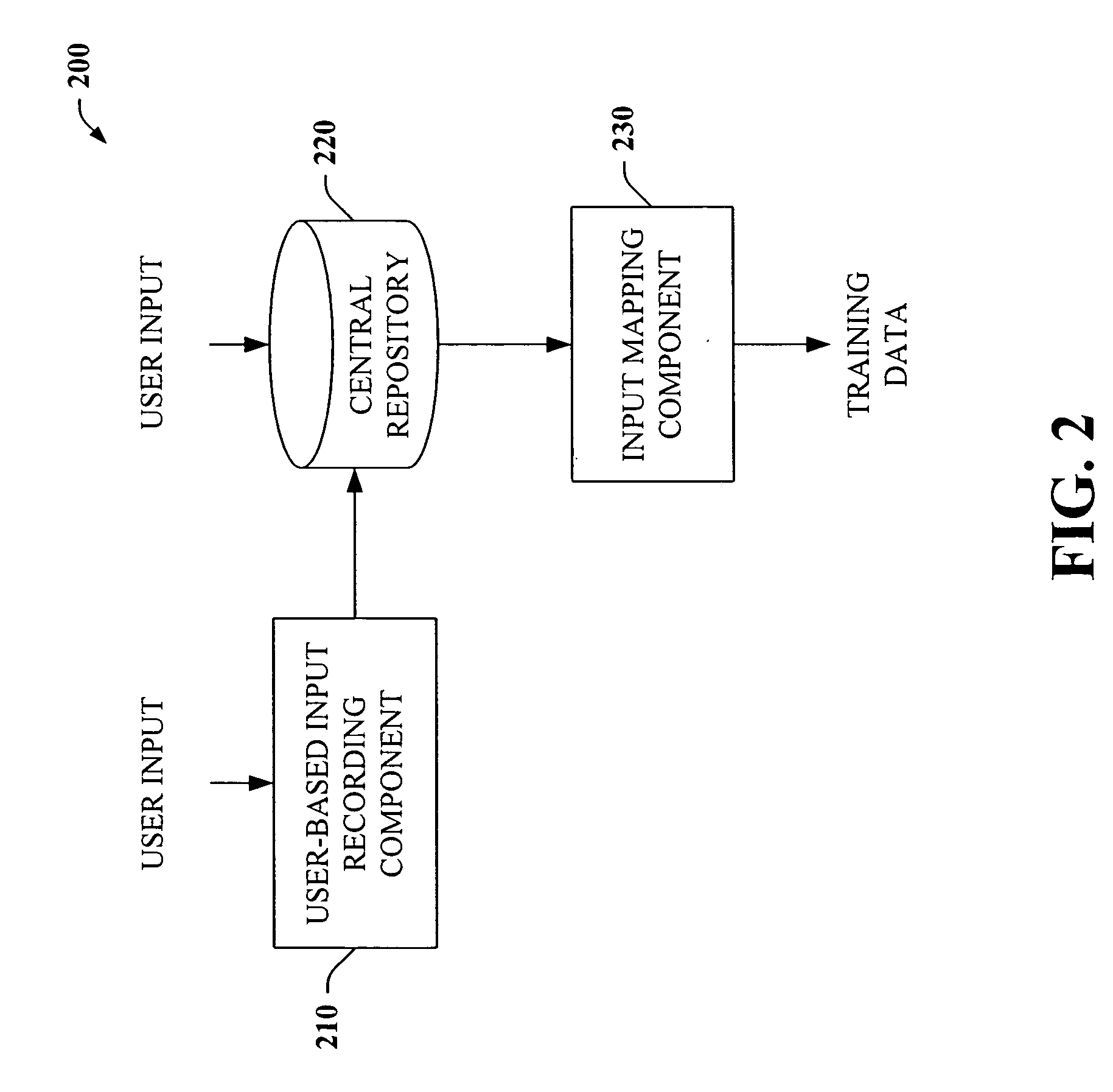

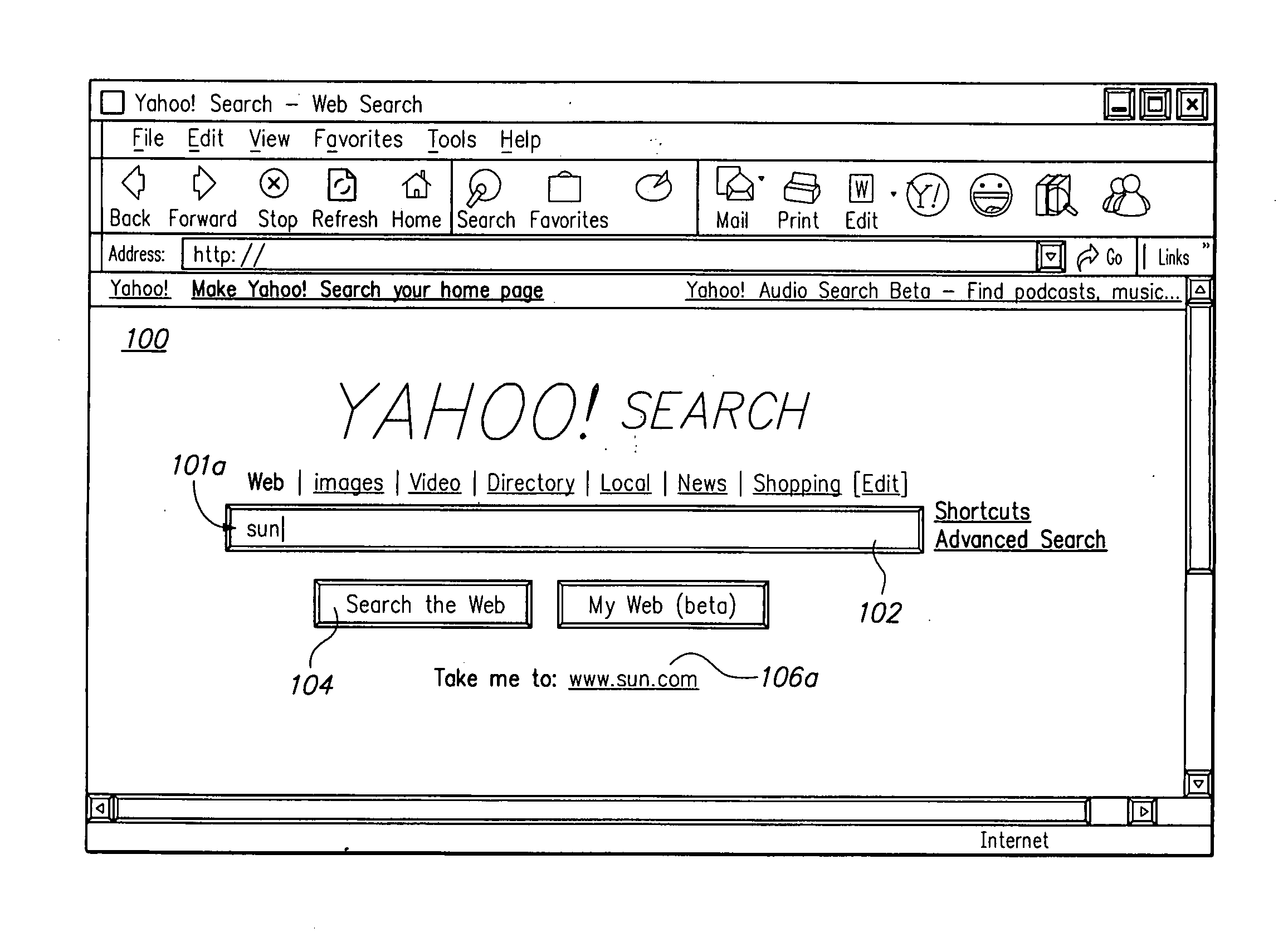

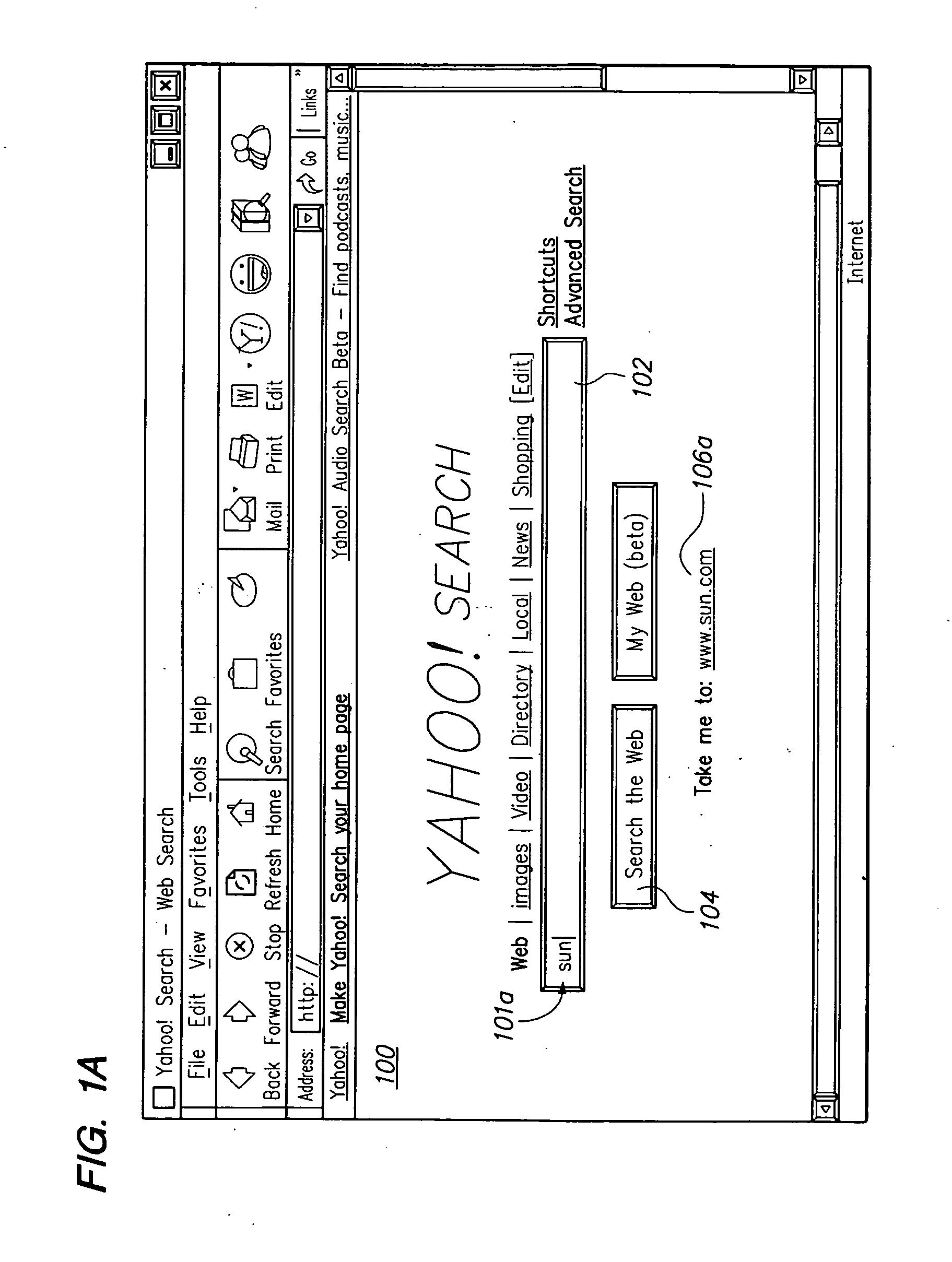

Intelligent autofill

InactiveUS20050257148A1Minimize effortData augmentationData processing applicationsMetal-working feeding devicesDatabaseCentral repository

The present invention provides a unique system and method that can employ machine learning techniques to automatically fill one or more fields across a diverse array of web forms. In particular, one or more instrumented tools can collect input or entries of form fields. Machine learning can be used to learn what data corresponds to which fields or types of fields. The input can be sent to a central repository where other databases can be aggregated as well. This input can be provided to a machine learning system to learn how to predict the desired outputs. Alternatively or in addition, learning can be performed in part by observing entries and then adapting the autofill component accordingly. Furthermore, a number of features of database fields as well as constraints can be employed to facilitate assignments of database entries to form values—particularly when the web form has never been seen before by the autofill system.

Owner:MICROSOFT TECH LICENSING LLC

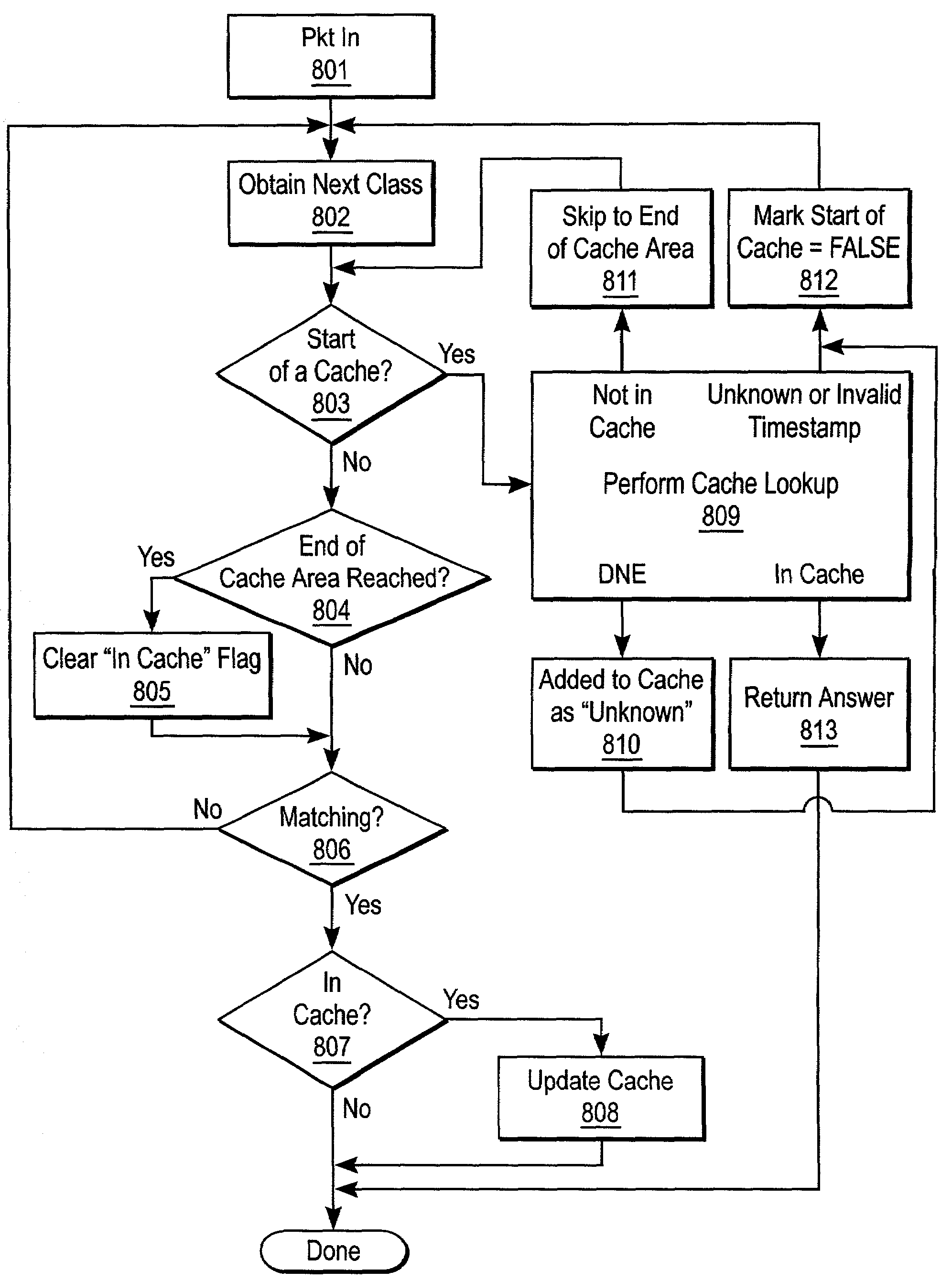

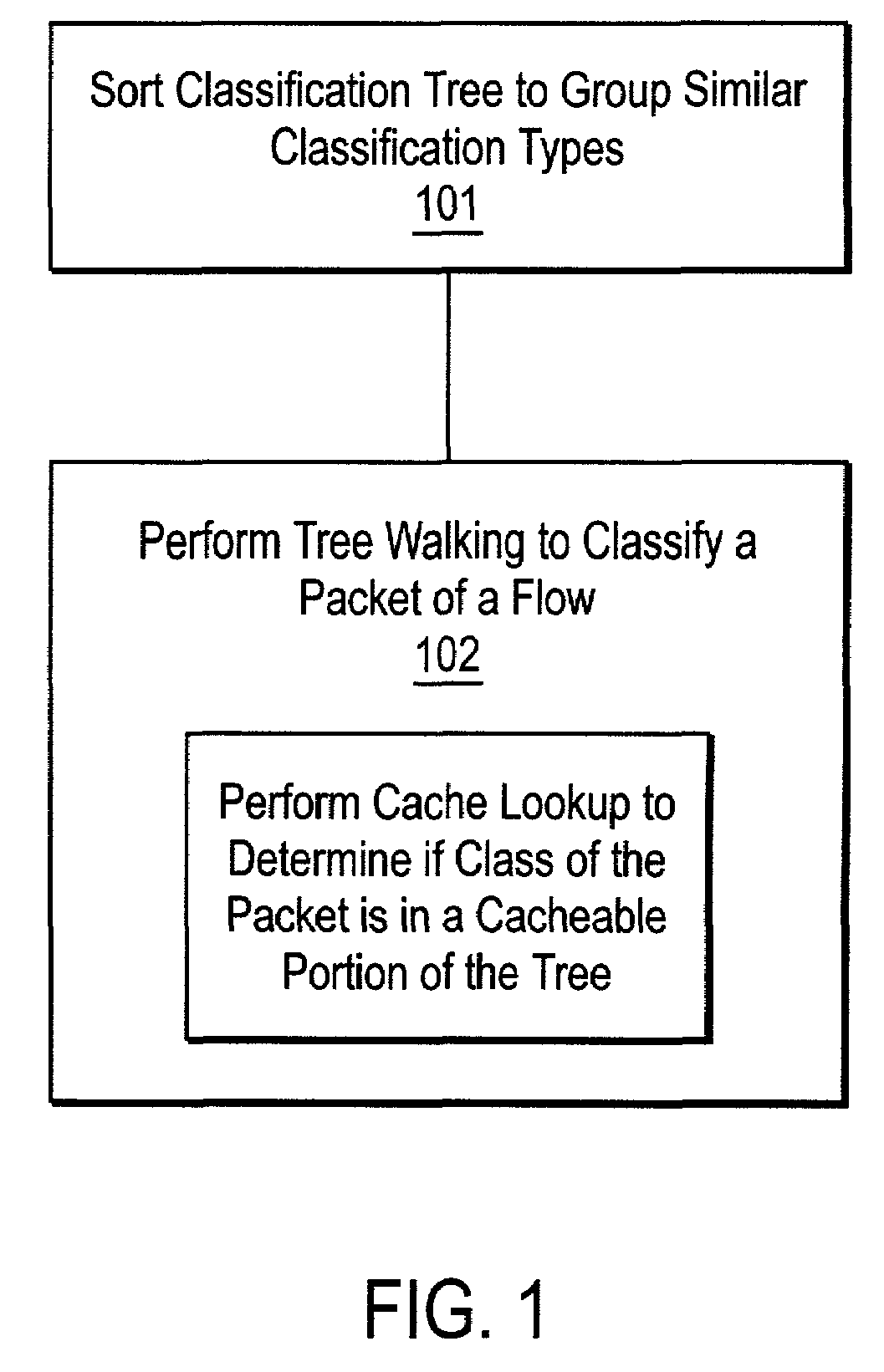

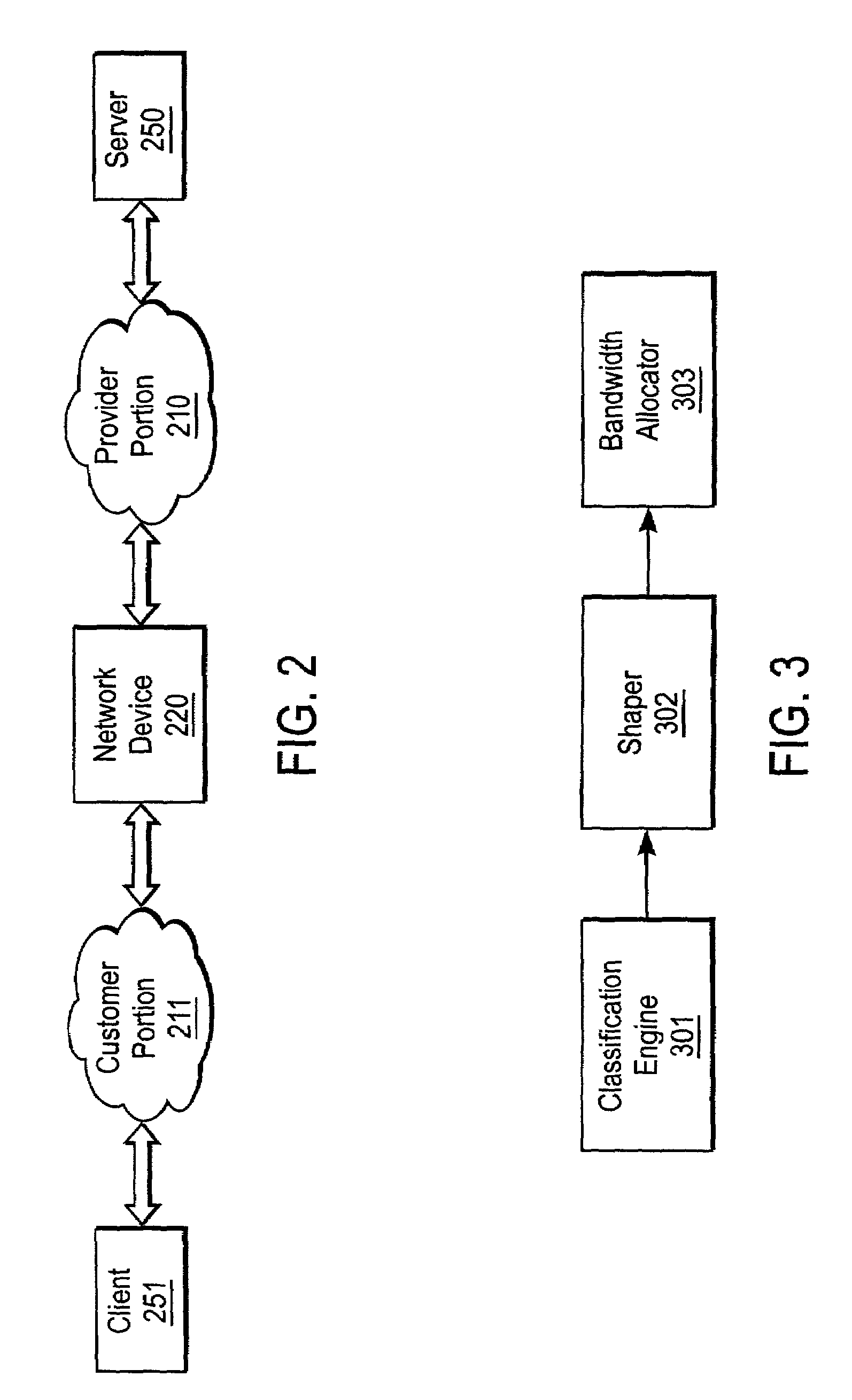

Method and apparatus for fast lookup of related classification entities in a tree-ordered classification hierarchy

ActiveUS7032072B1Error preventionFrequency-division multiplex detailsClassification typesData mining

A method and apparatus for performing classification in a hierarchical classification system performing caching are described. In one embodiment, the method comprises walking a classification tree in the hierarchical classification system to determine whether an incoming flow matches a class in the classification tree, and performing a lookup on a cache storing a data structure of multiple classes of one classification type to compare the incoming flow with multiple classes at the same time to determine whether the incoming flow matches one of the classes.

Owner:CA TECH INC

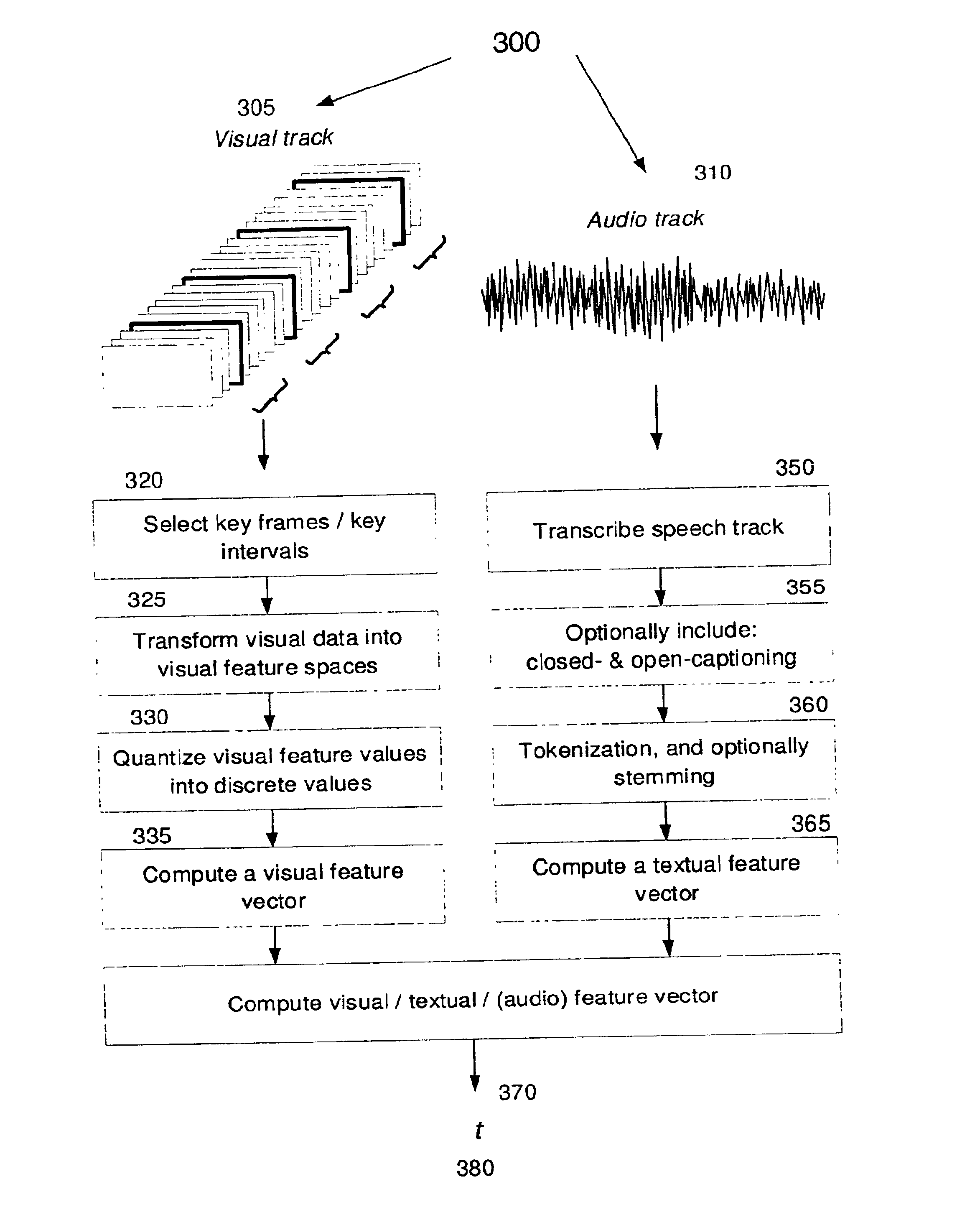

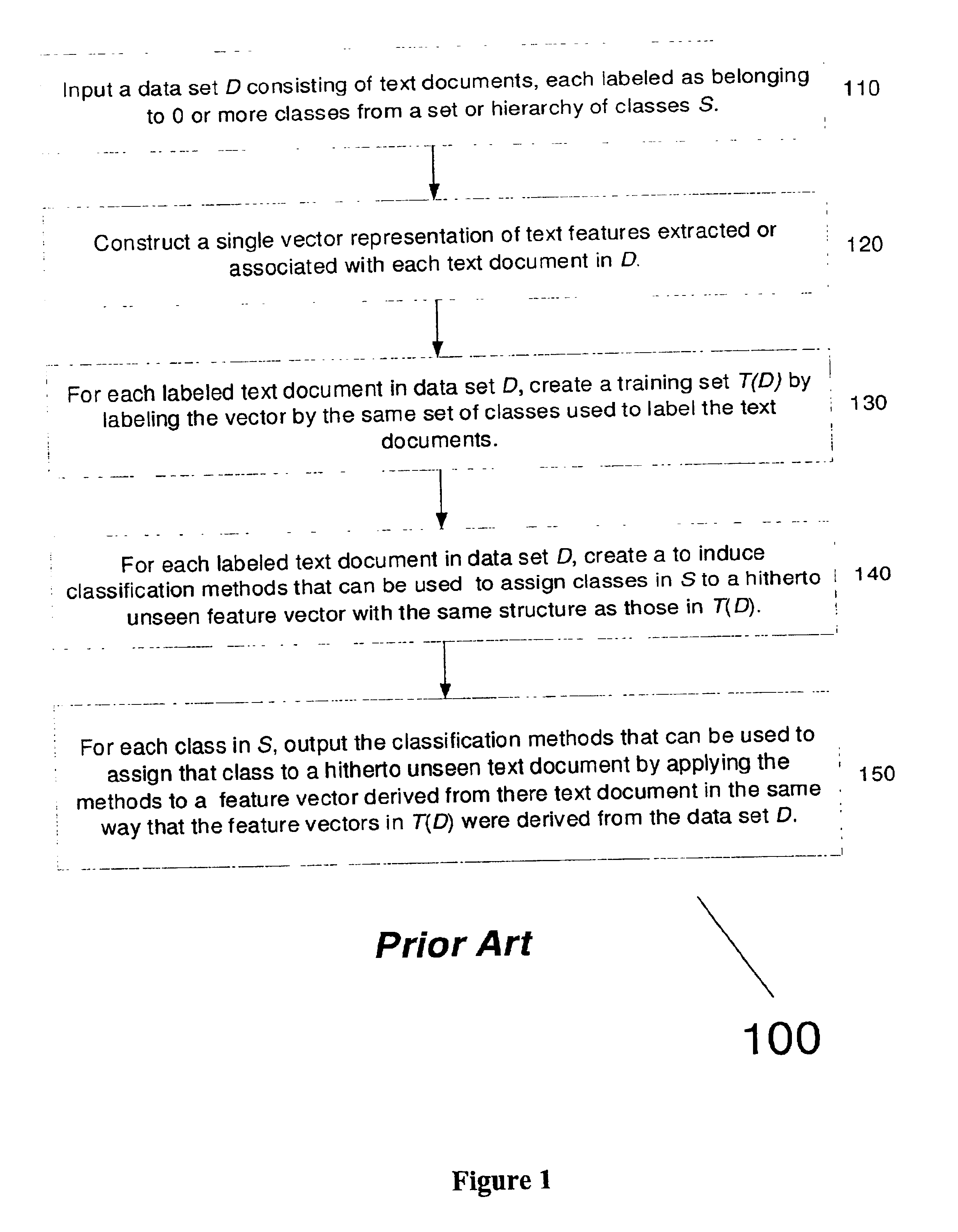

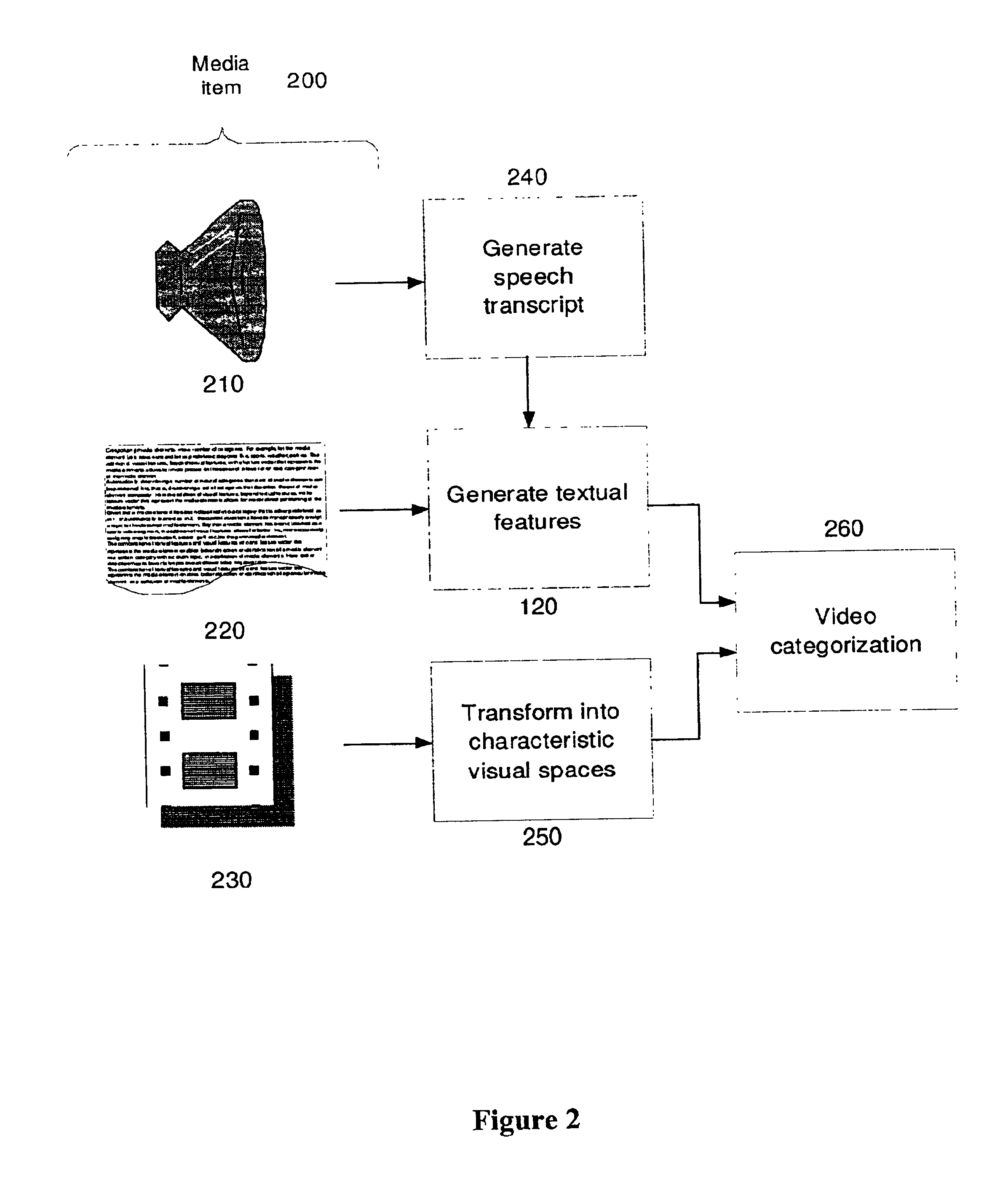

Method and apparatus for inducing classifiers for multimedia based on unified representation of features reflecting disparate modalities

InactiveUS6892193B2Improve performanceAssure compatibilityDigital data information retrievalDigital data processing detailsFeature vectorSubject matter

This invention is a system and method to perform categorization (classification) of multimedia items. These items are comprised of a multitude of disparate information sources, in particular, visual information and textual information. Classifiers are induced based on combining textual and visual feature vectors. Textual features are the traditional ones, such as, word count vectors. Visual features include, but are not limited to, color properties of key intervals and motion properties of key intervals. The visual feature vectors are determined in such a fashion that the vectors are sparse. The vector components are features such as the absence or presence of the color green in spatial regions and the absence or the amount of visual flow in spatial regions of the media items. The text and the visual representation vectors are combined in a systematic and coherent fashion. This vector representation of a media item lends itself to well-established learning techniques. The resulting system, subject of this invention, categorizes (or classifies) media items based both on textual features and visual features.

Owner:IBM CORP

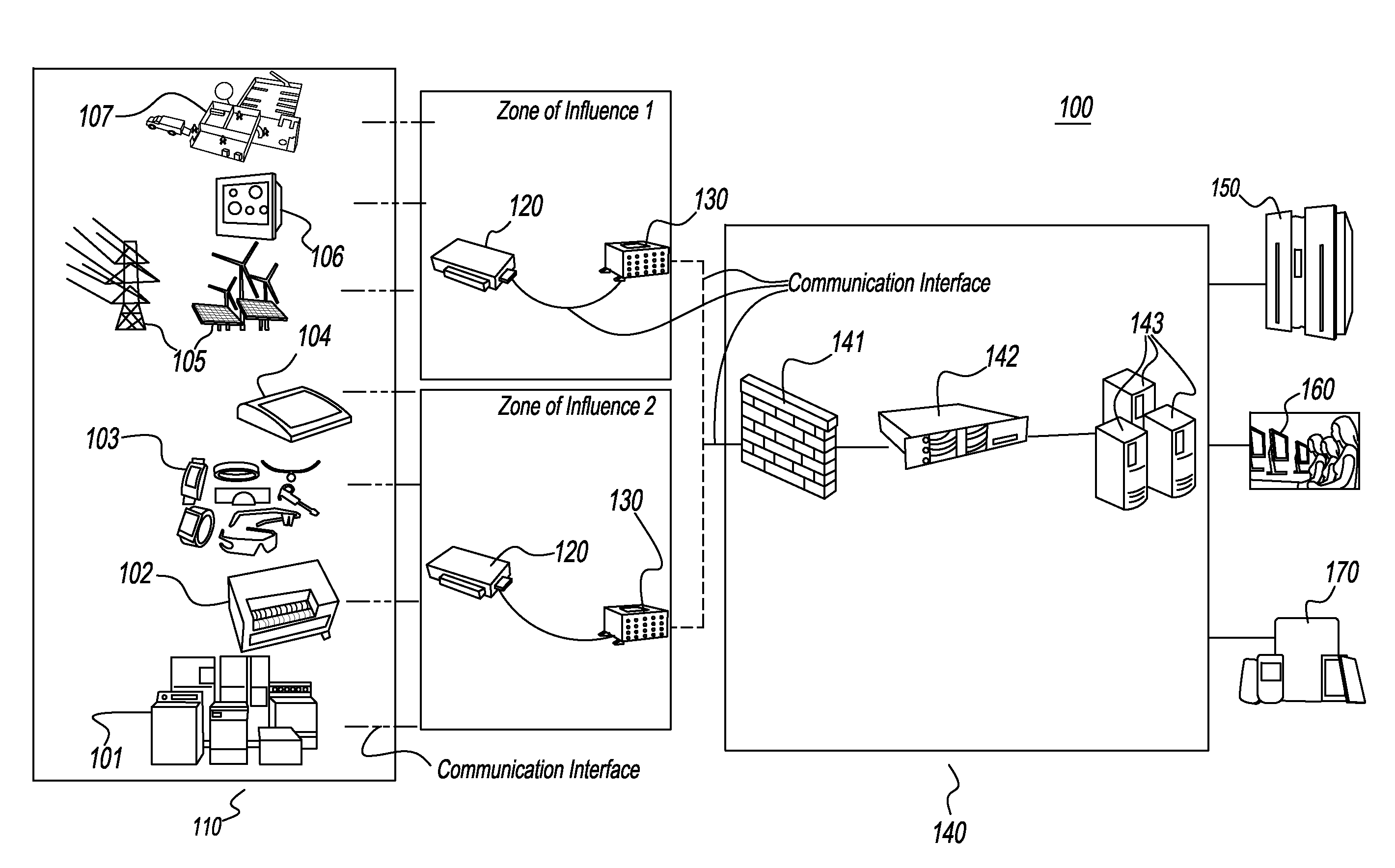

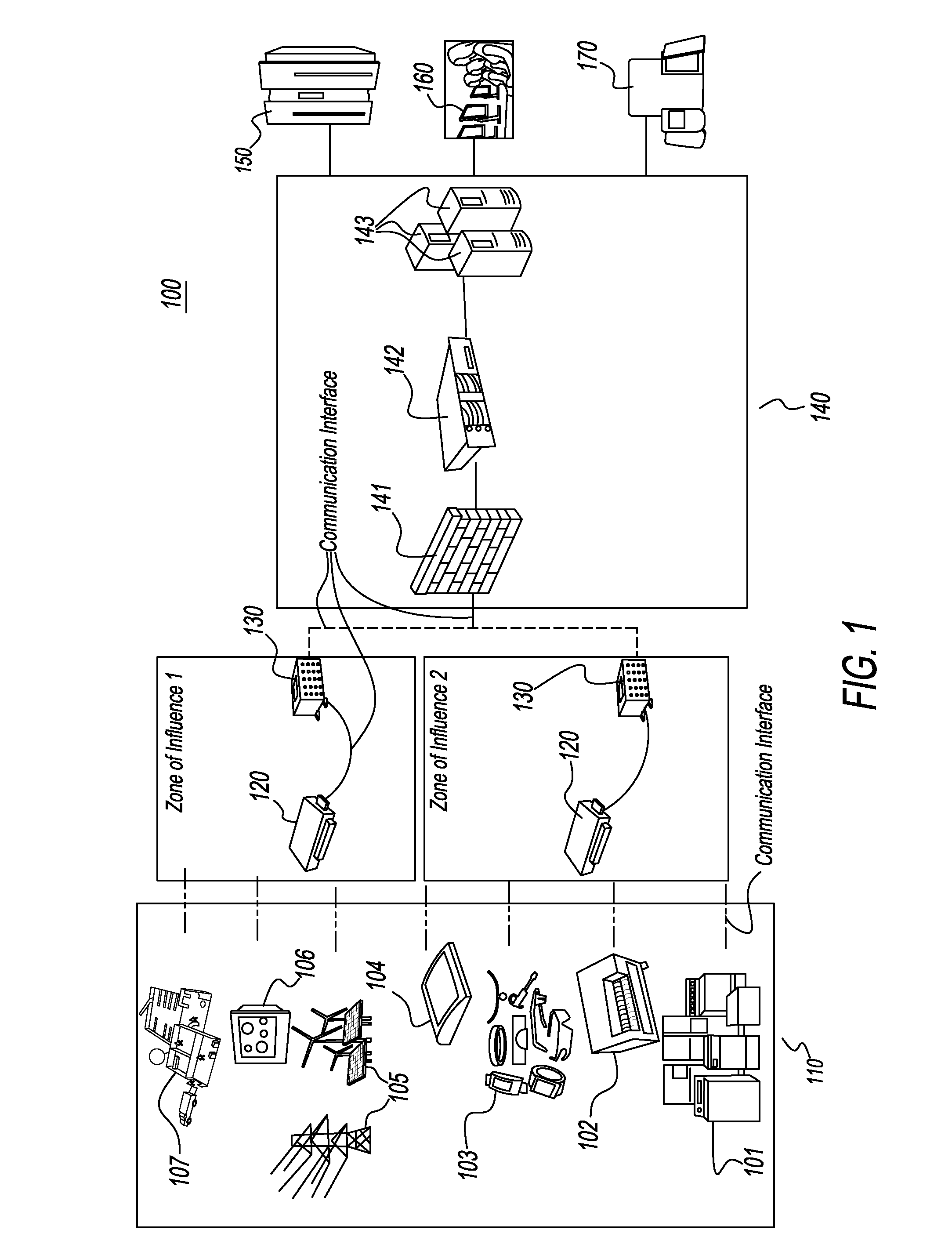

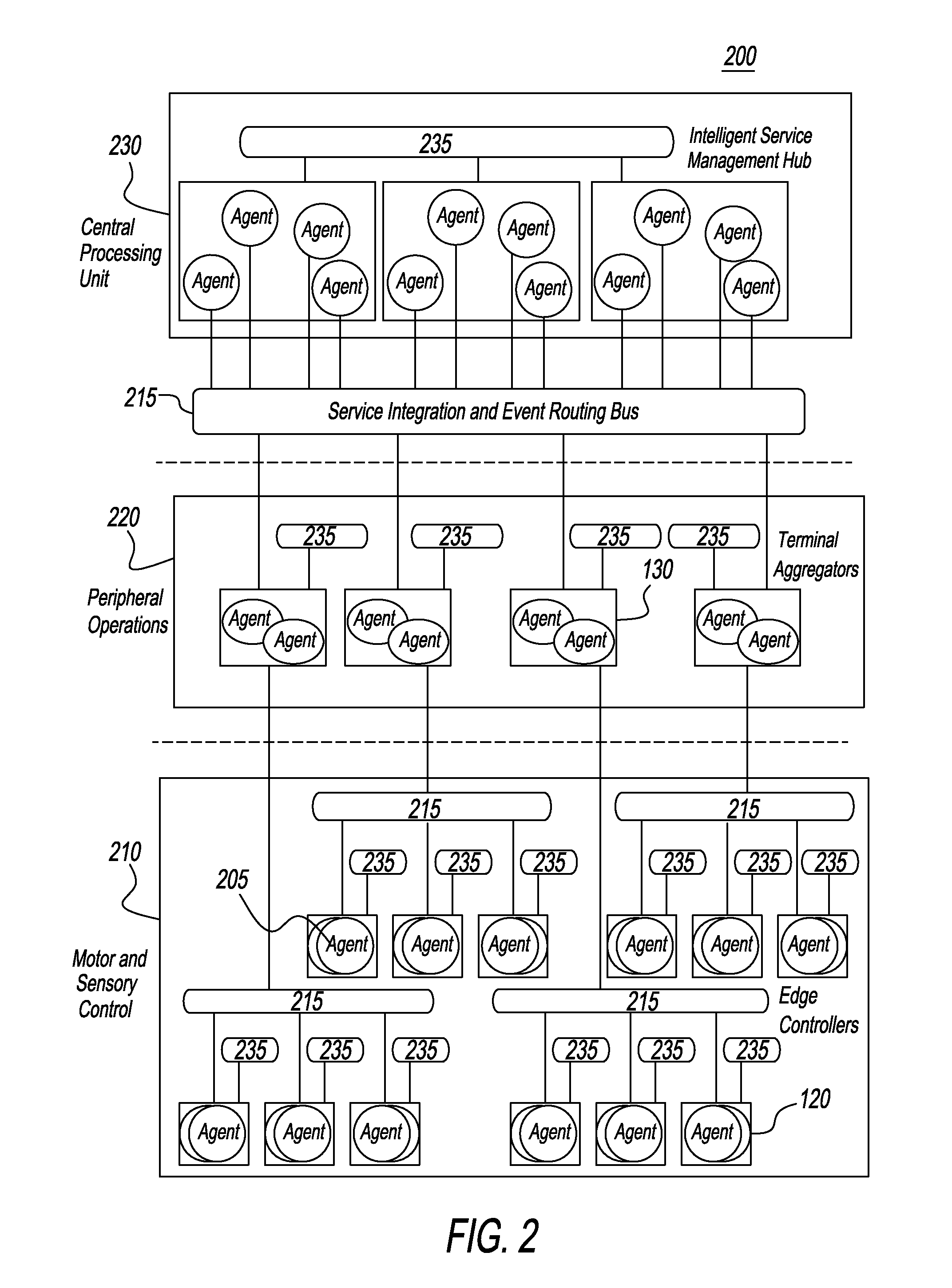

Cognitive Intelligence Platform for Distributed M2M/ IoT Systems

InactiveUS20170006141A1Condition may changeEasy to operateNetwork topologiesTransmissionNervous systemCollective intelligence

Systems and methods to leverage and manage data and knowledge in a M2M or Internet of Things (IoT) network are provided. More particularly, a cognitive intelligence platform for an IoT network that provides autonomic decision support system at or near real-time and executes a dynamic runtime is provided. The hardware, software and communication design of the platform replicates the structural and operational model of the human nervous system to achieve cognitive intelligence through adaptation, collaborative learning, knowledge sharing and self-adjustment. Further, in one embodiment, the cognitive intelligence platform has three logical processing layers of increasing complexity, each of which has agents that use statistical and machine learning techniques and algorithms to resolve situational needs and update knowledge. Furthermore, each processing layer of the platform has a basic level of intelligence and additionally the hierarchy of layers aggregates the learning and intelligence at each layer.

Owner:BHADRA PRASENJIT

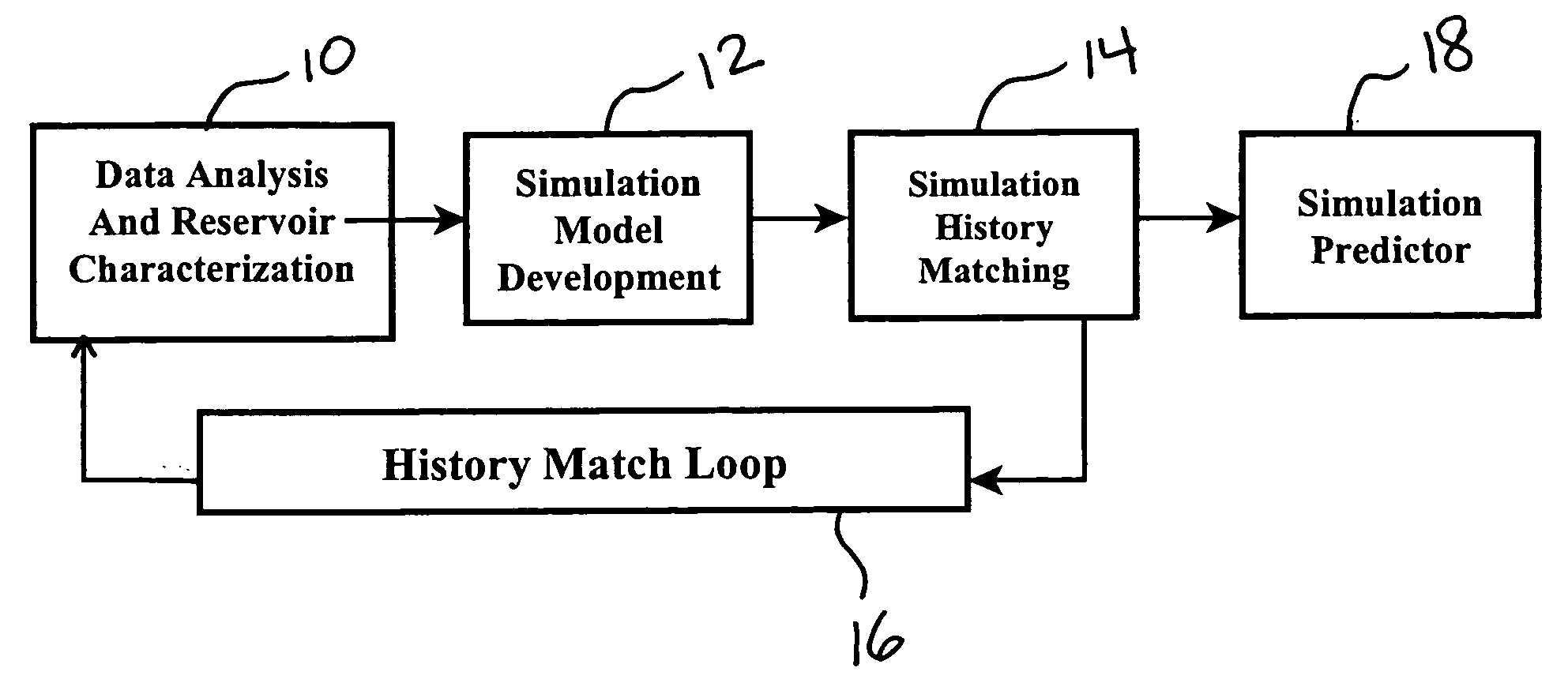

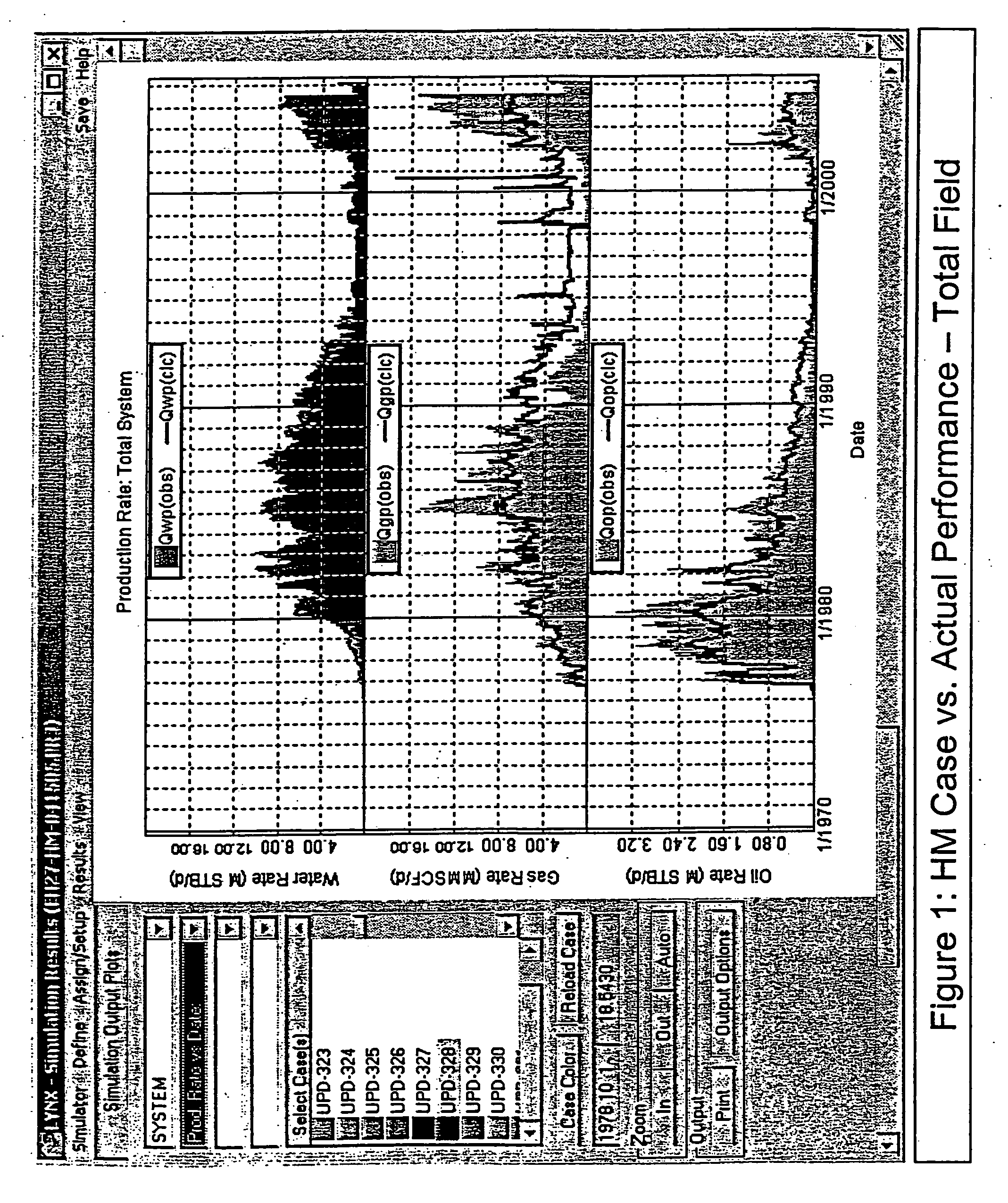

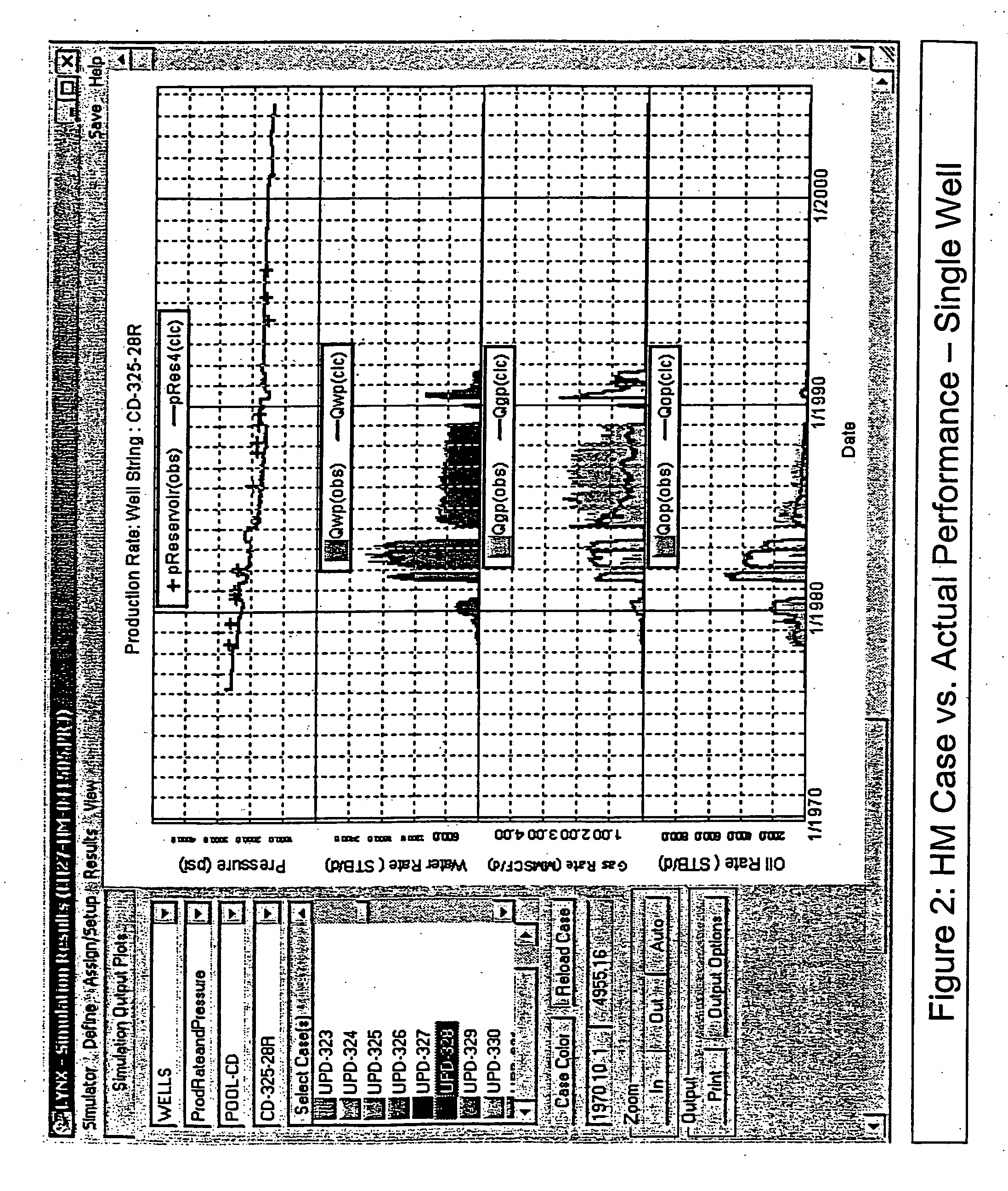

Method and system for accelerating and improving the history matching of a reservoir simulation model

InactiveUS20070016389A1Improve predicted recoveryFaster and reliable pressureSurveyGeomodellingNerve networkErrors and residuals

The present invention, in one embodiment, is directed to a method and system for accelerating and improving the history matching of a well bore and / or reservoir simulation model using a neural network. The neural network provides a correlation between the calculated history match error and a selected set of parameters that characterize the well bore and / or the reservoir. The neural network iteratively varies a selection and / or the value of the parameters to provide at least one set of history match parameters having a value that provides a minimum for the calculated history matching error.

Owner:OZGEN CETIN

Systems and methods for investigation of financial reporting information

InactiveUS20050222929A1FinanceSpecial data processing applicationsCluster algorithmStatistical analysis

Owner:PRICEWATERHOUSECOOPERS LLP

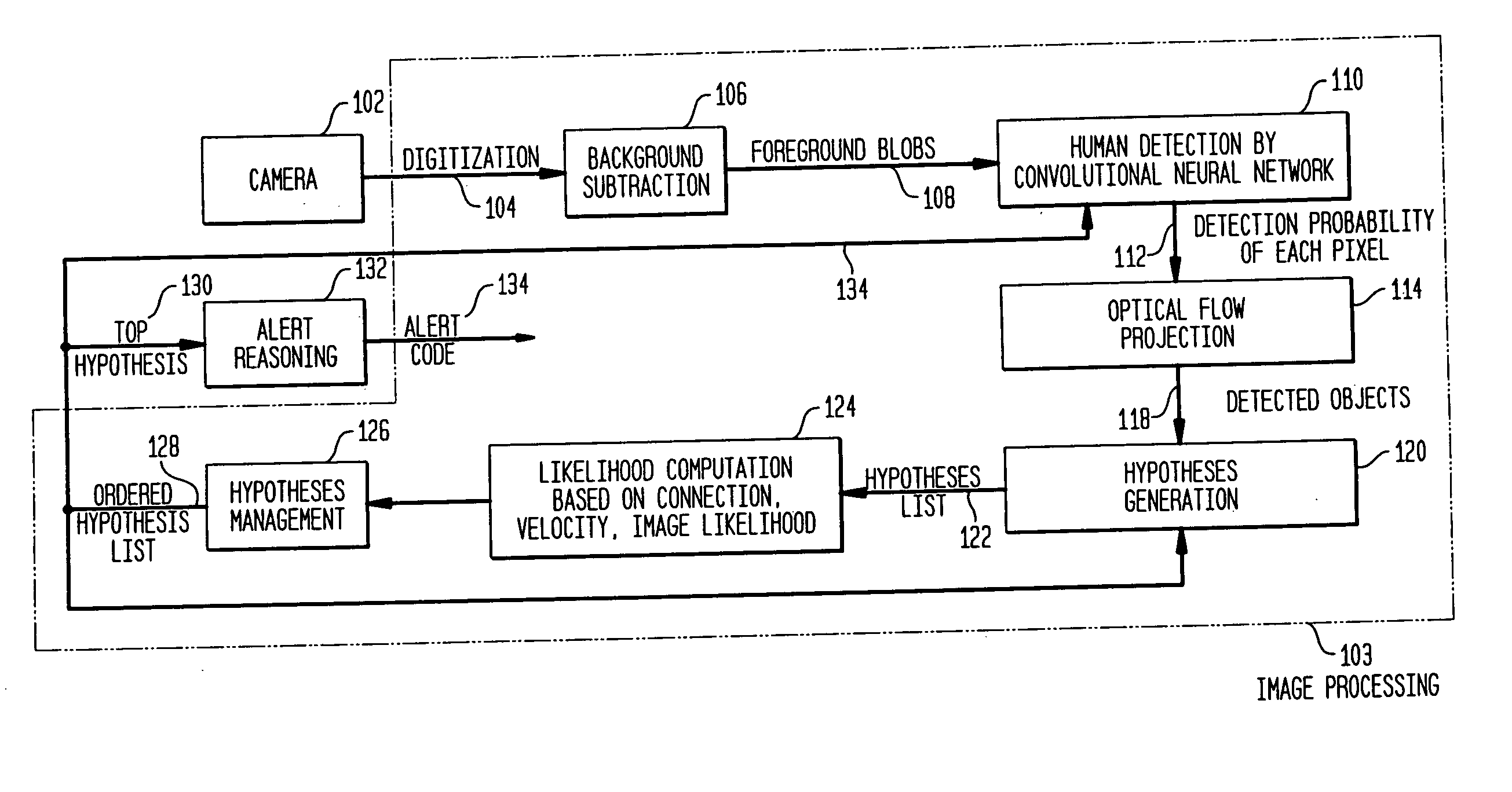

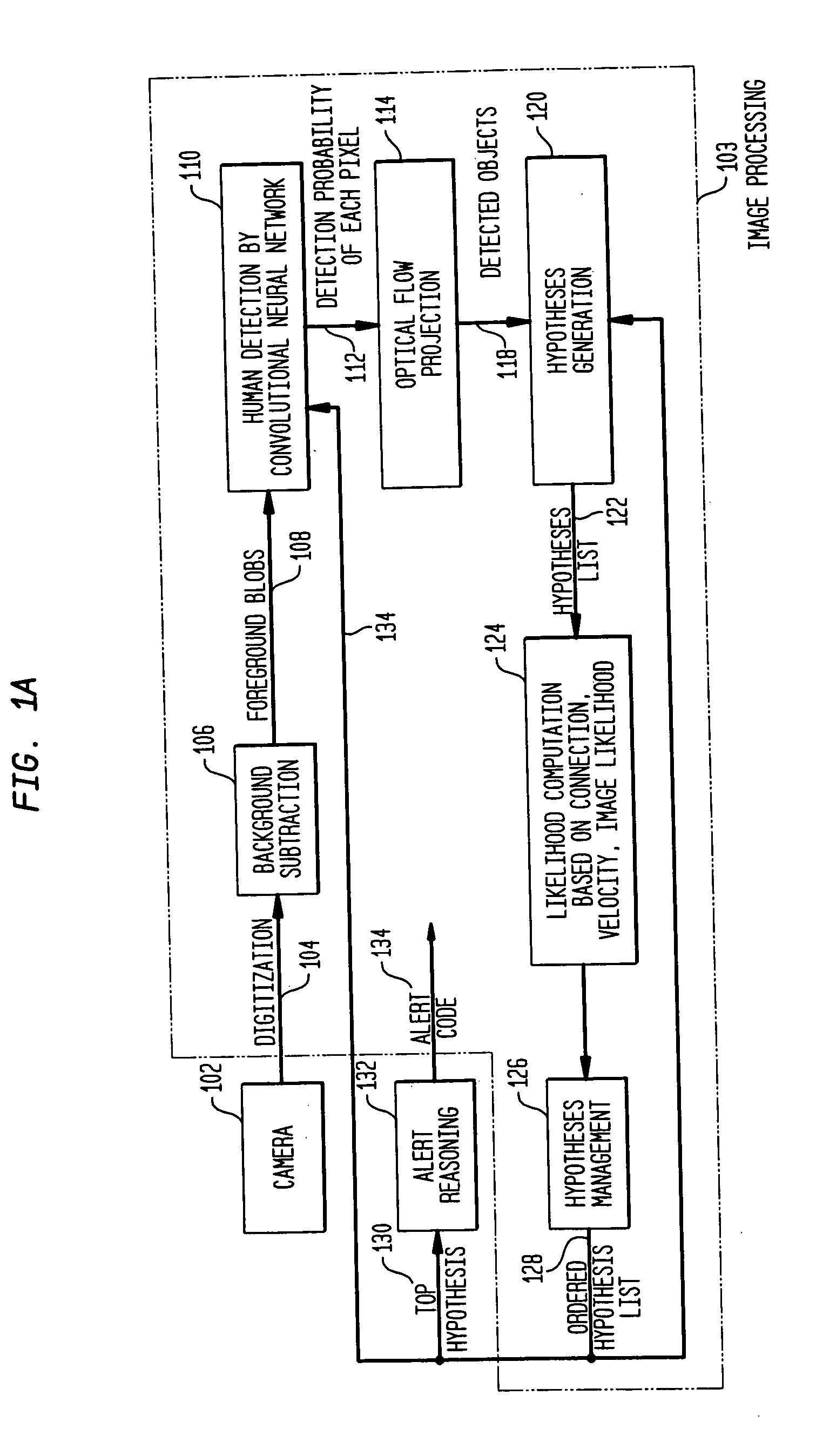

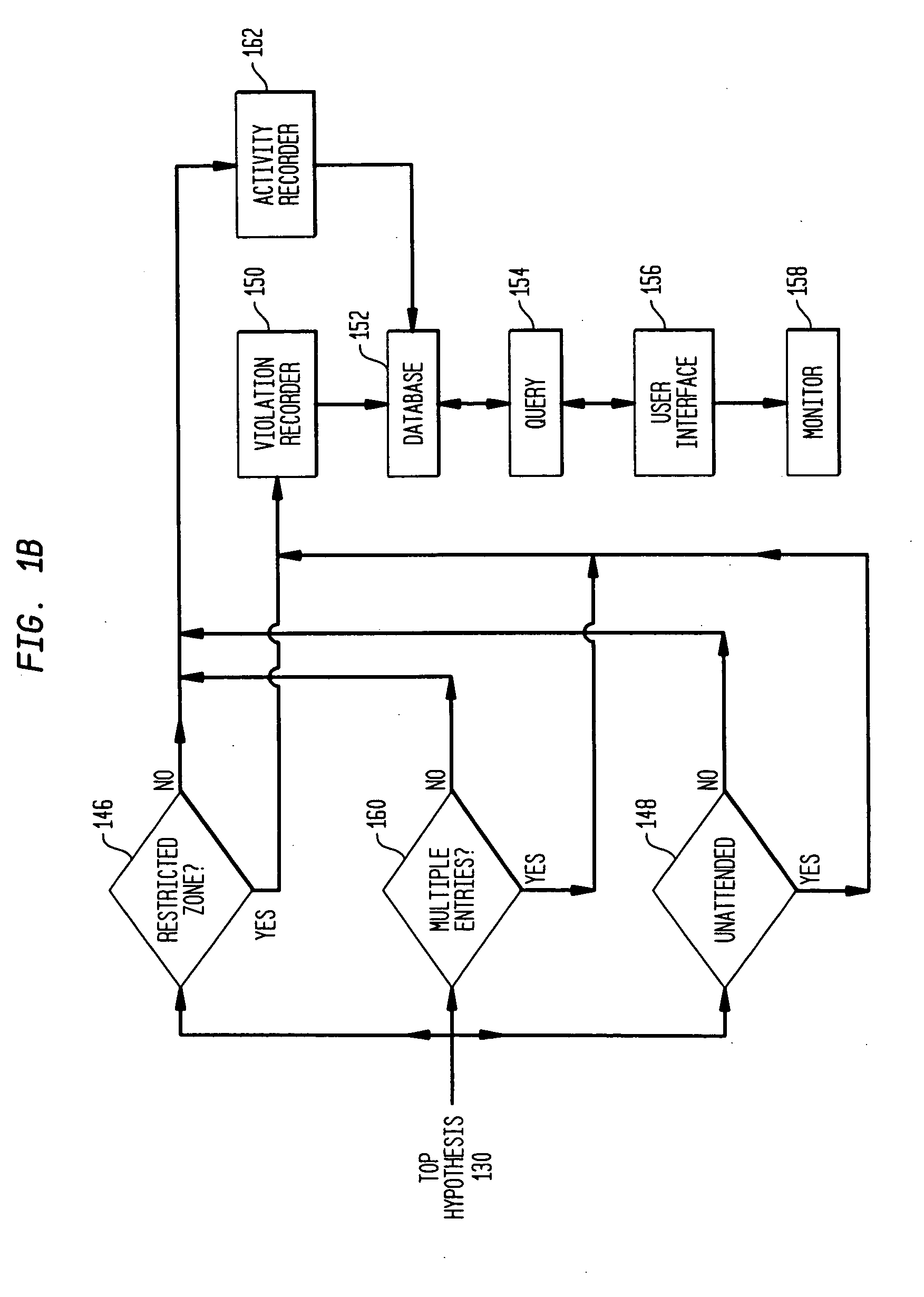

Video surveillance system with object detection and probability scoring based on object class

A video surveillance system uses rule-based reasoning and multiple-hypothesis scoring to detect predefined behaviors based on movement through zone patterns. Trajectory hypothesis spawning allows for trajectory splitting and / or merging and includes local pruning to managed hypothesis growth. Hypotheses are scored based on a number of criteria, illustratively including at least one non-spatial parameter. Connection probabilities computed during the hypothesis spawning process are based on a number of criteria, illustratively including object size. Object detection and probability scoring is illustratively based on object class.

Owner:AXIS

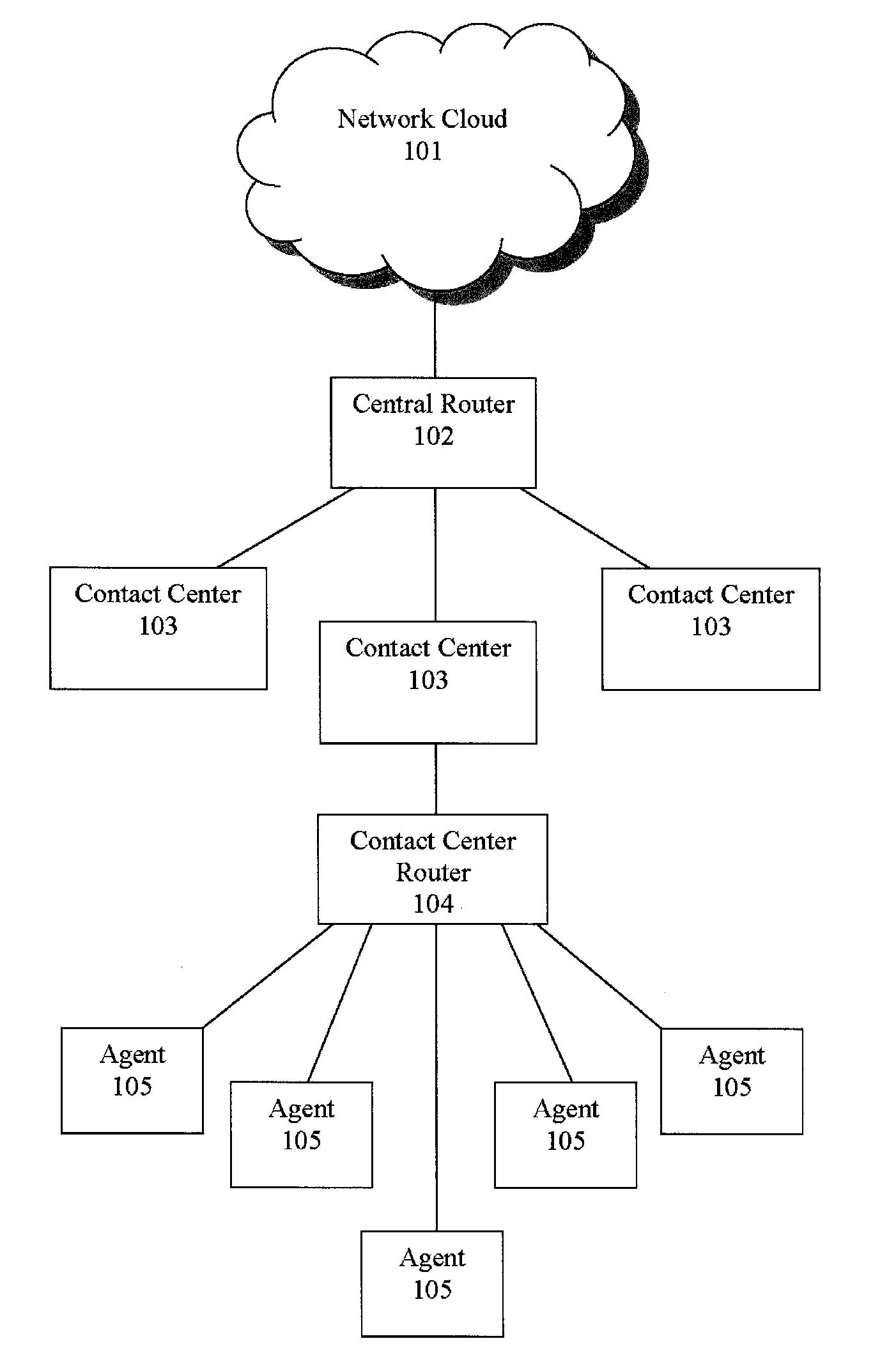

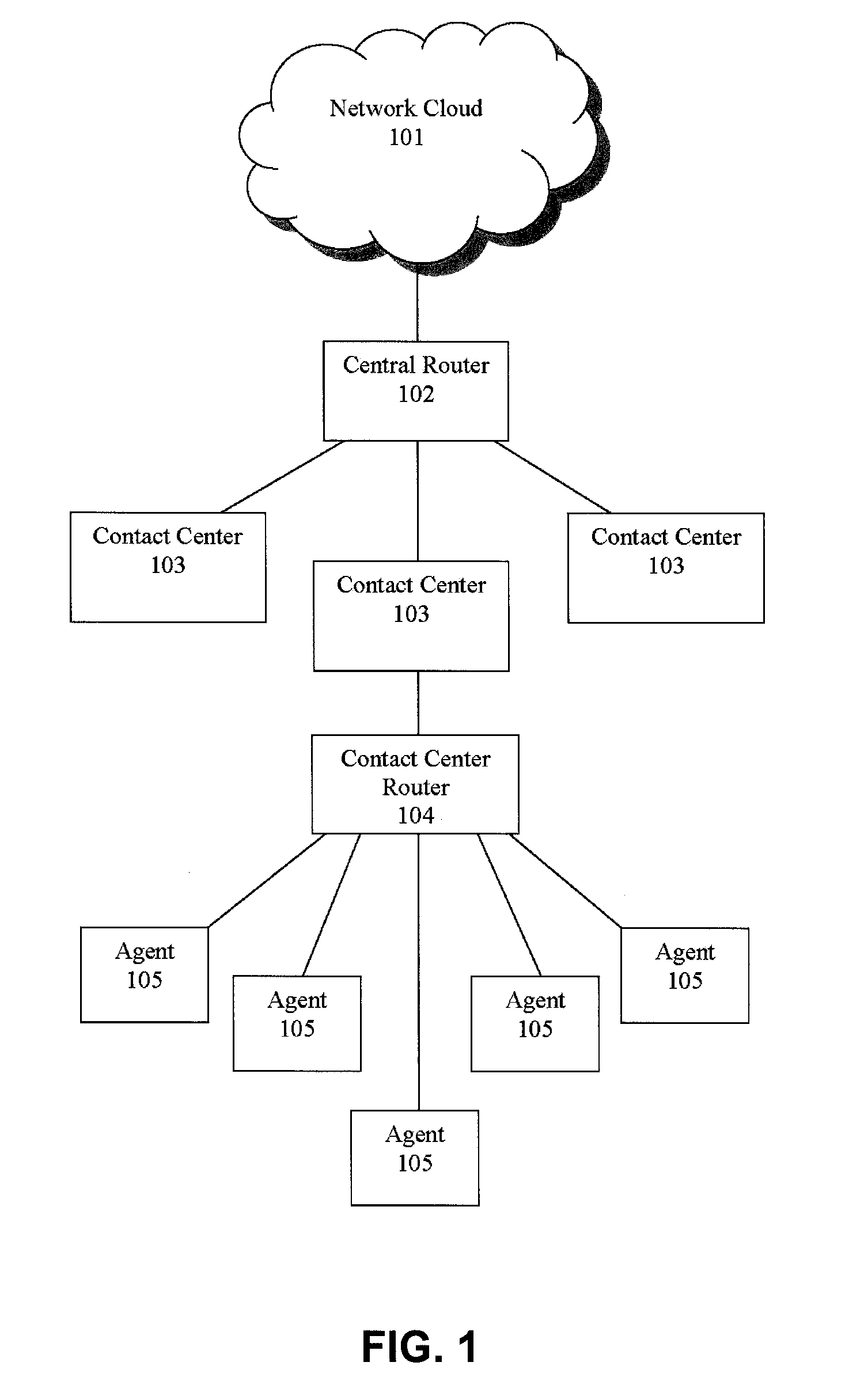

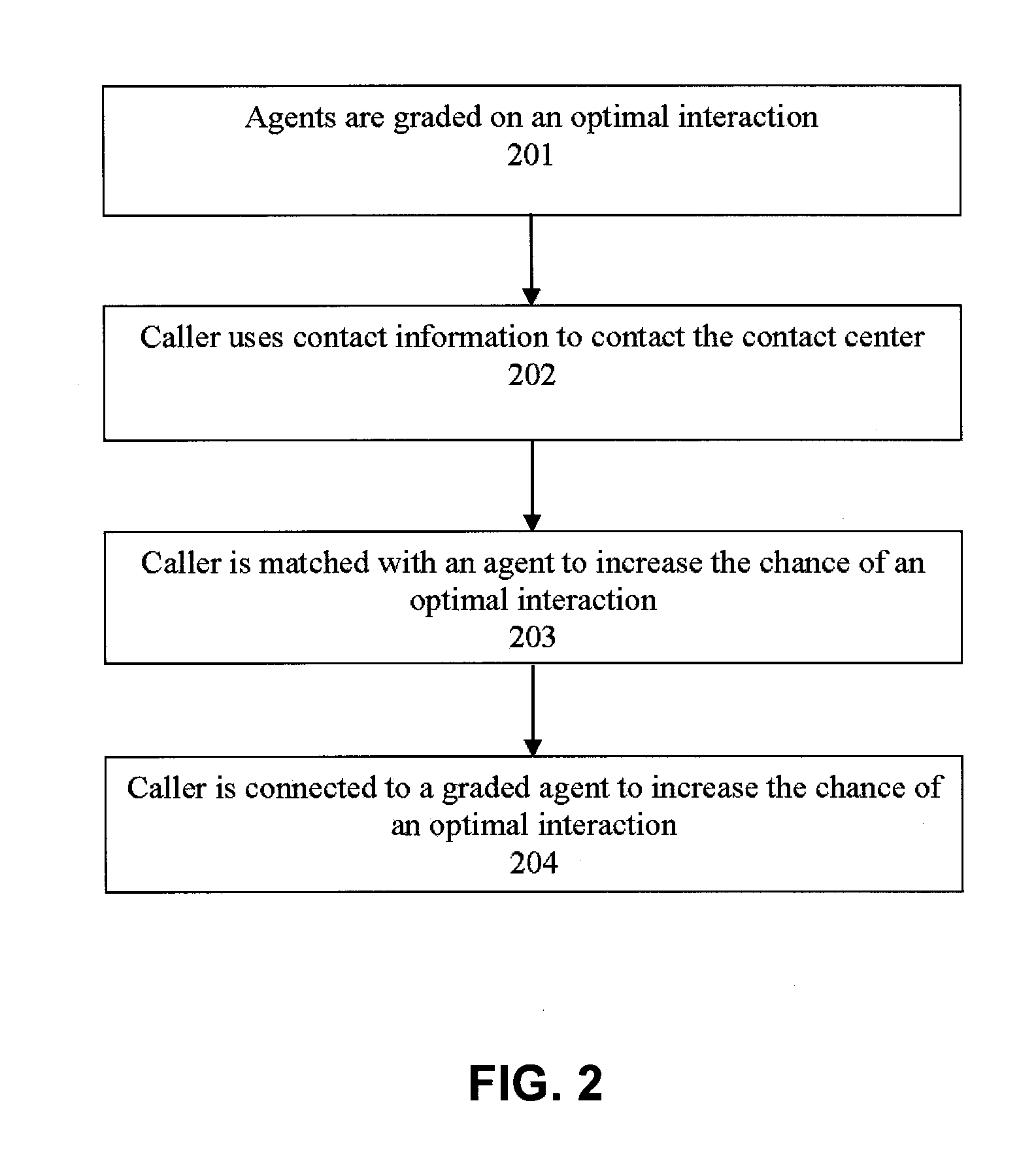

Routing callers to agents based on personality data of agents

Systems and methods are disclosed for routing callers to agents in a contact center, along with an intelligent routing system. An exemplary method includes routing a caller from a set of callers to an agent from a set of agents based on a pattern matching algorithm utilizing caller data associated with the caller from the set of callers and agent data associated with the agent from the set of agents. One or both of the caller data and agent data includes personality data, e.g., from a personality profile, associated with the caller or agent. The personality data and profile may be generated from administration of a personality test such as a Myers-Brigg Type Indicator questionnaire.

Owner:AFINITI LTD

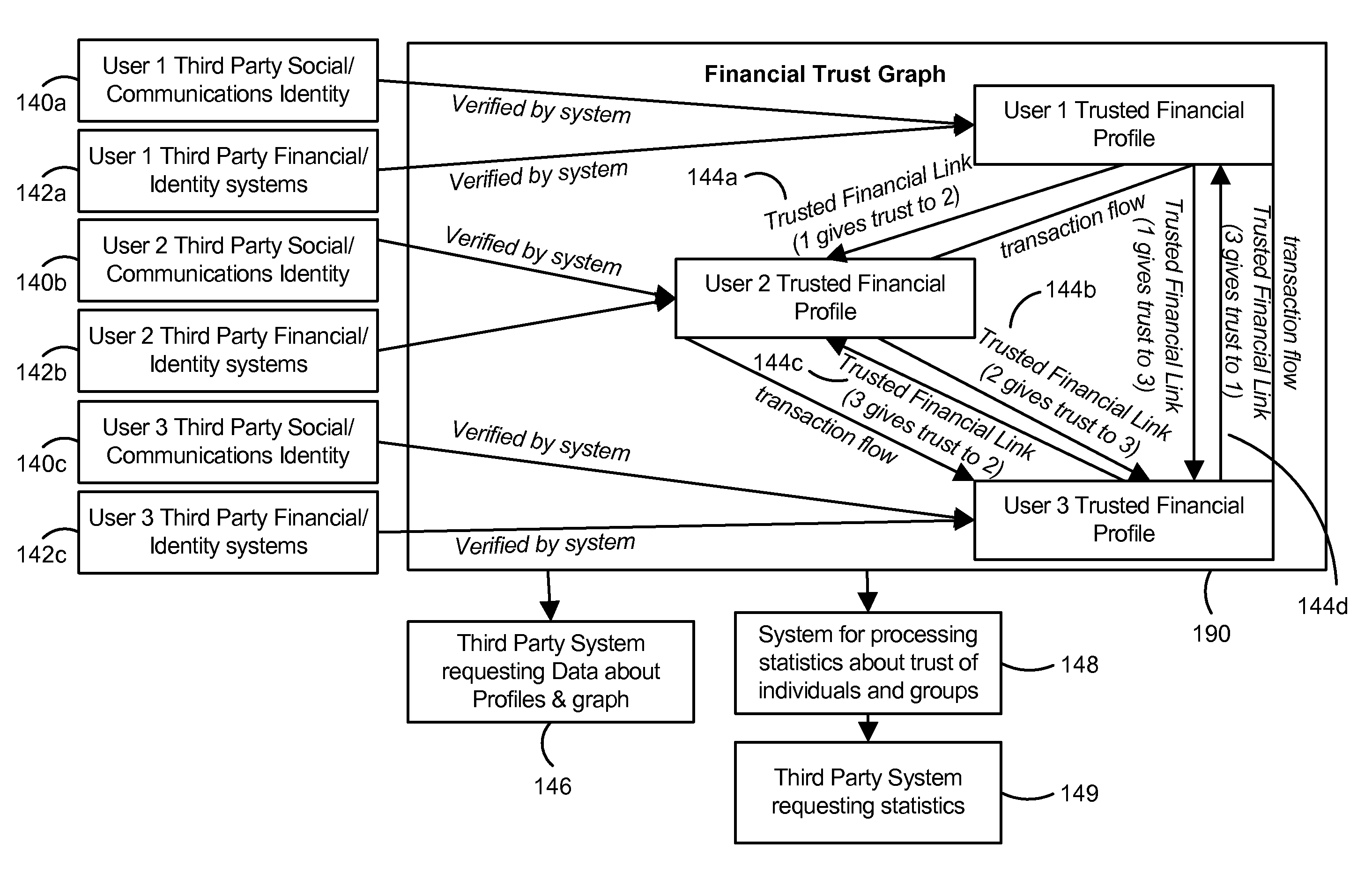

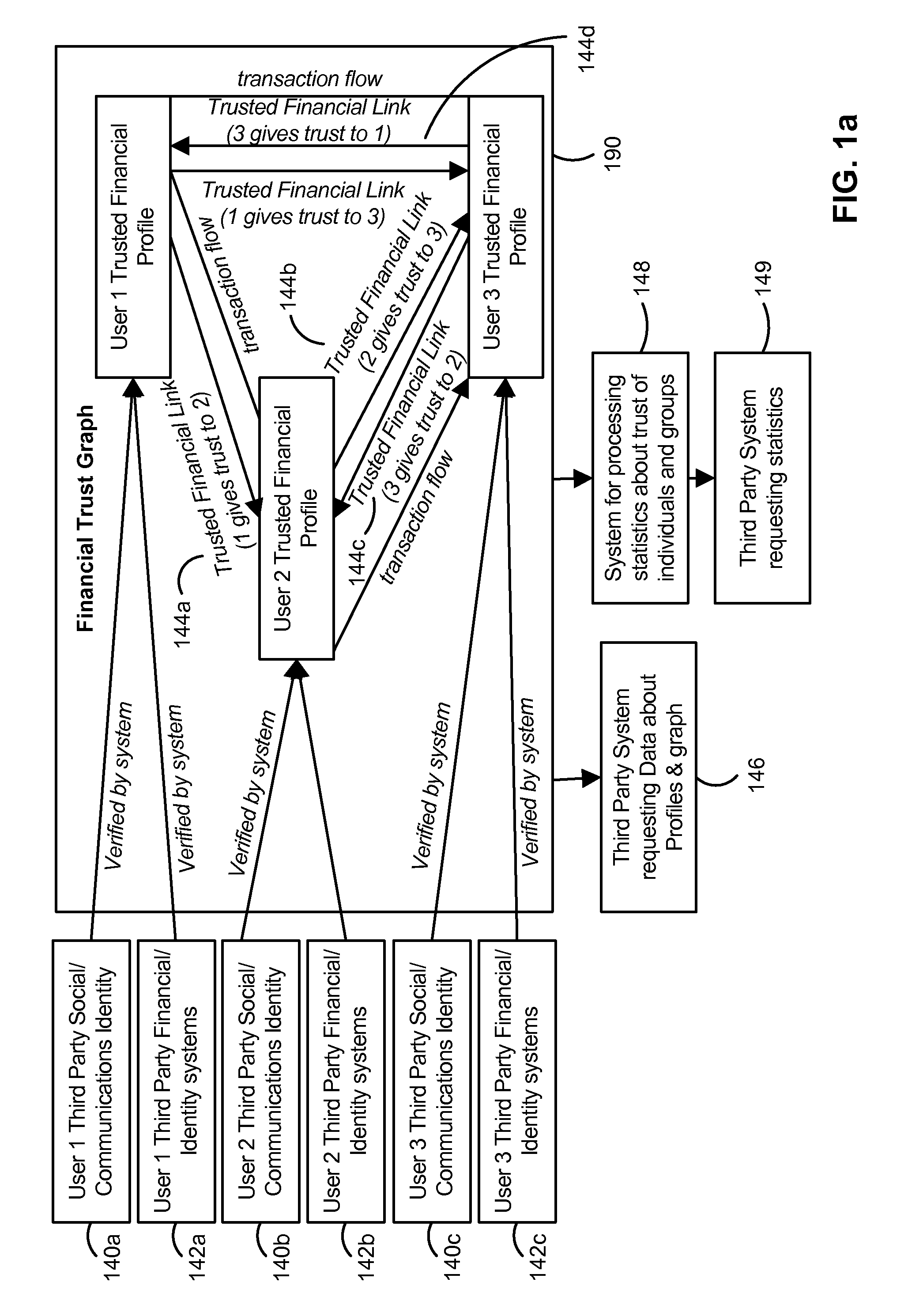

Trust Based Transaction System

A configuration for more efficient electronic financial transactions is disclosed. Users input personal and financial information into a system that validates the information to generate trusted financial profiles. Each user can establish trusted financial links with other users. The trusted financial link provides a mechanism for the user to allow other users to withdraw money from the link provider account. The data from these relationships and the financial data flowing through the system enable a measure of trustworthiness of users and the trustworthiness of all interactions in the system. The combination of trusted financial profiles, trusted financial links, and financial transactions between users create a measurable financial trust graph which is a true representation of the trusting economic relationships among the users. The financial trust graph enables a more accurate assessment of the creditworthiness and financial risk of transactions by users with little or no credit or transaction history.

Owner:PAYPAL INC

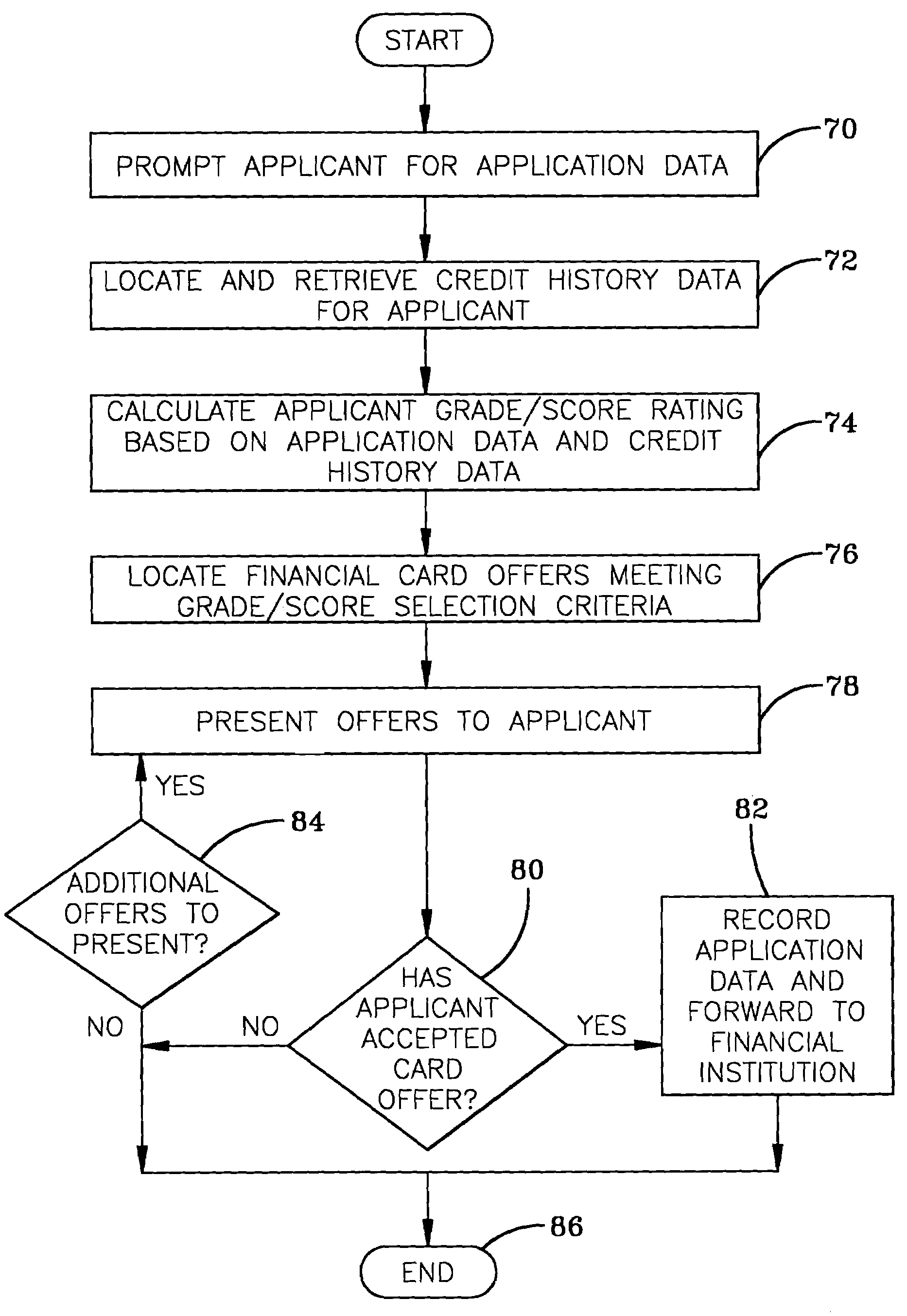

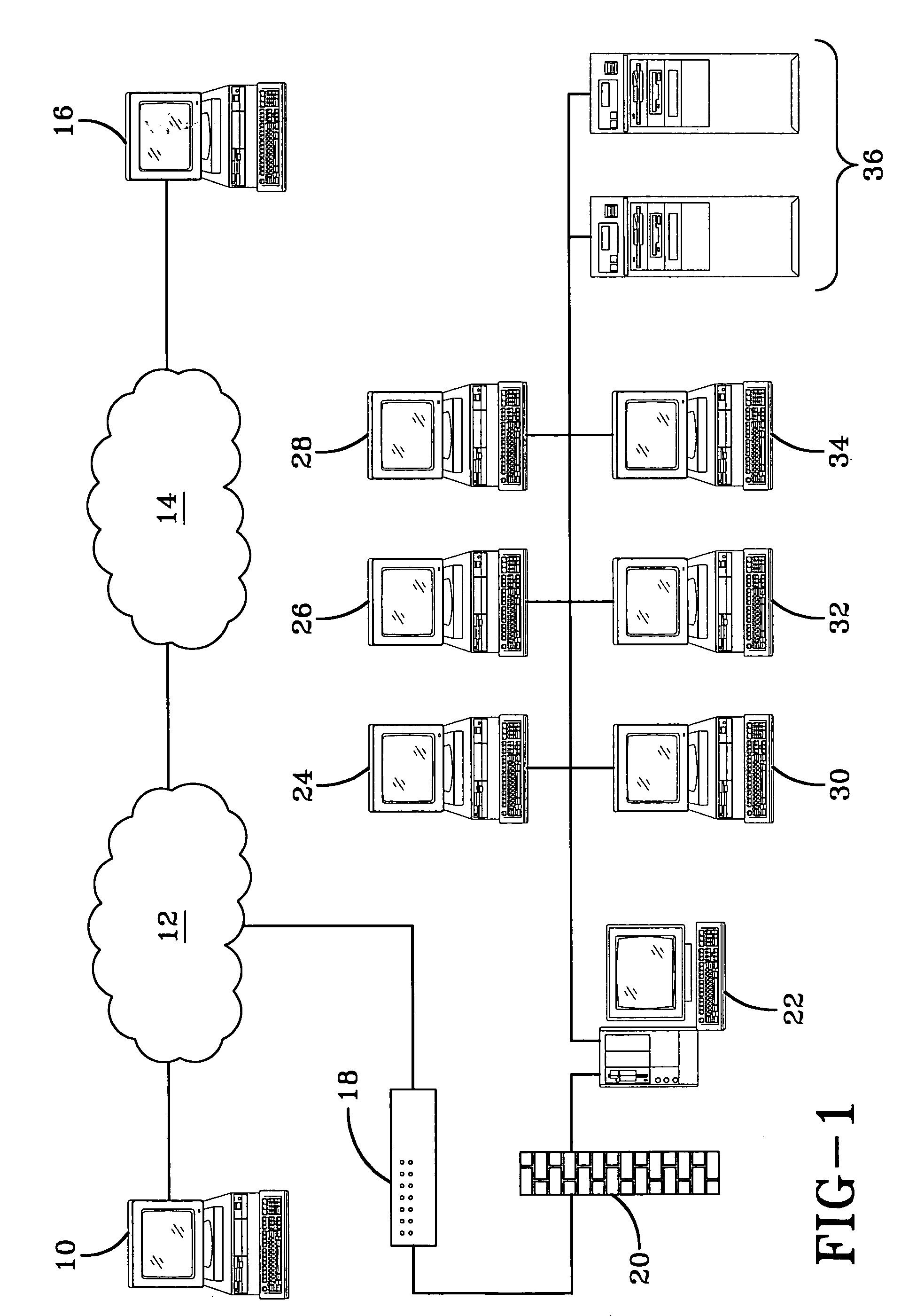

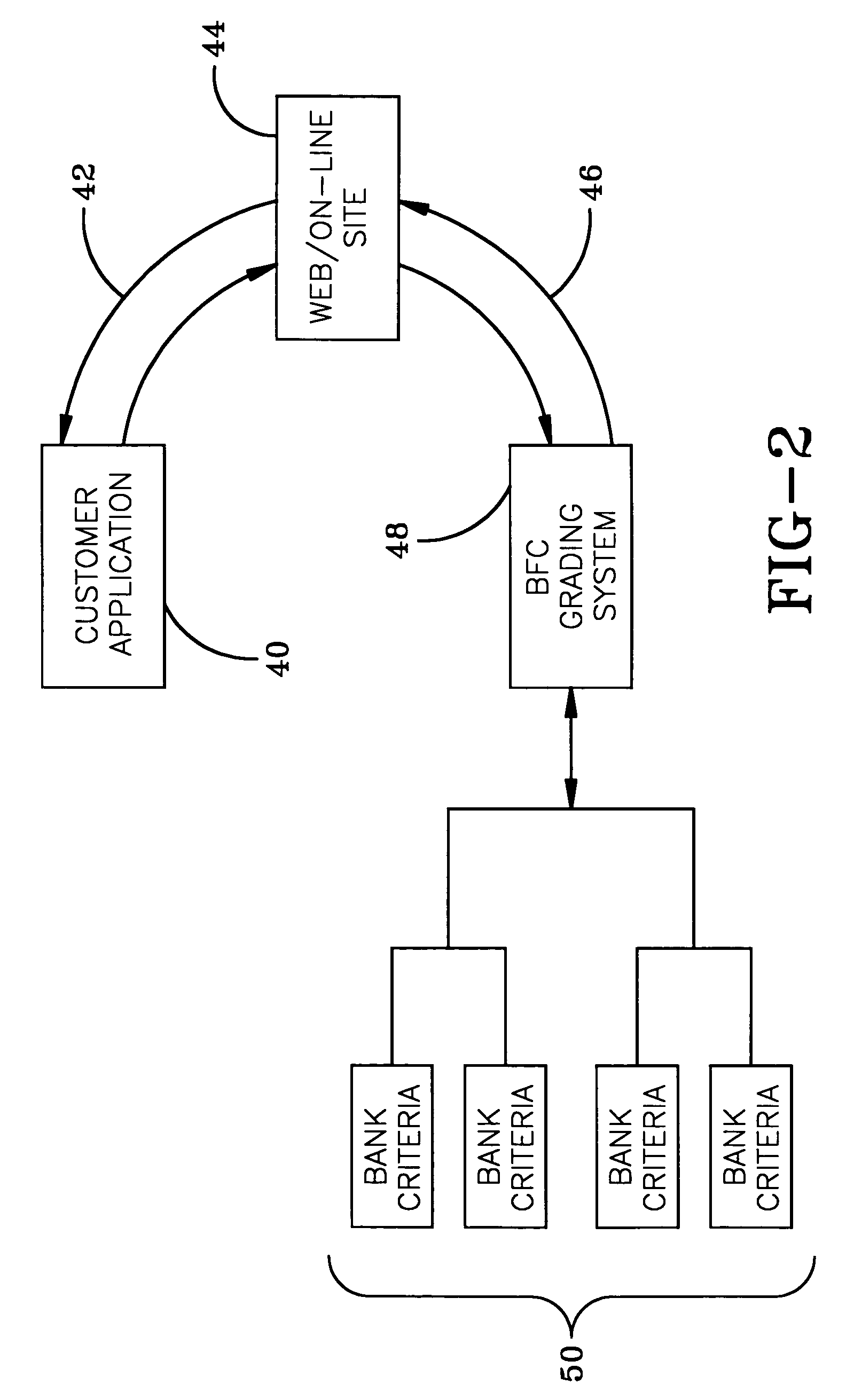

Real-time financial card offer and application system

A system is disclosed for presenting financial card (e.g., credit card, debit card) offers to potential customers. Financial card applicant selection criteria and financial card term data are provided by participating financial institutions. An applicant interested in applying for a new financial card accesses the system via the Internet / World Wide Web. The applicant provides personal and financial data that are then analyzed in conjunction with data from outside sources (such as credit bureaus) to determine a financial risk rating for the applicant. The rating is used to locate financial card offers appropriate for the applicant. The applicant then peruses the offers and chooses one that meets his or her personal selection criteria. The applicant's data is then forwarded for processing to the participating financial institution that made the selected offer.

Owner:BLOCK FINANCIAL

Human face super-resolution reconstruction method based on generative adversarial network and sub-pixel convolution

ActiveCN107154023AImprove recognition accuracyClear outline of the faceGeometric image transformationNeural architecturesData setImage resolution

The invention discloses a human face super-resolution reconstruction method based on a generative adversarial network and sub-pixel convolution, and the method comprises the steps: A, carrying out the preprocessing through a normally used public human face data set, and making a low-resolution human face image and a corresponding high-resolution human face image training set; B, constructing the generative adversarial network for training, adding a sub-pixel convolution to the generative adversarial network to achieve the generation of a super-resolution image and introduce a weighted type loss function comprising feature loss; C, sequentially inputting a training set obtained at step A into a generative adversarial network model for modeling training, adjusting the parameters, and achieving the convergence; D, carrying out the preprocessing of a to-be-processed low-resolution human face image, inputting the image into the generative adversarial network model, and obtaining a high-resolution image after super-resolution reconstruction. The method can achieve the generation of a corresponding high-resolution image which is clearer in human face contour, is more specific in detail and is invariable in features. The method improves the human face recognition accuracy, and is better in human face super-resolution reconstruction effect.

Owner:UNIV OF ELECTRONICS SCI & TECH OF CHINA

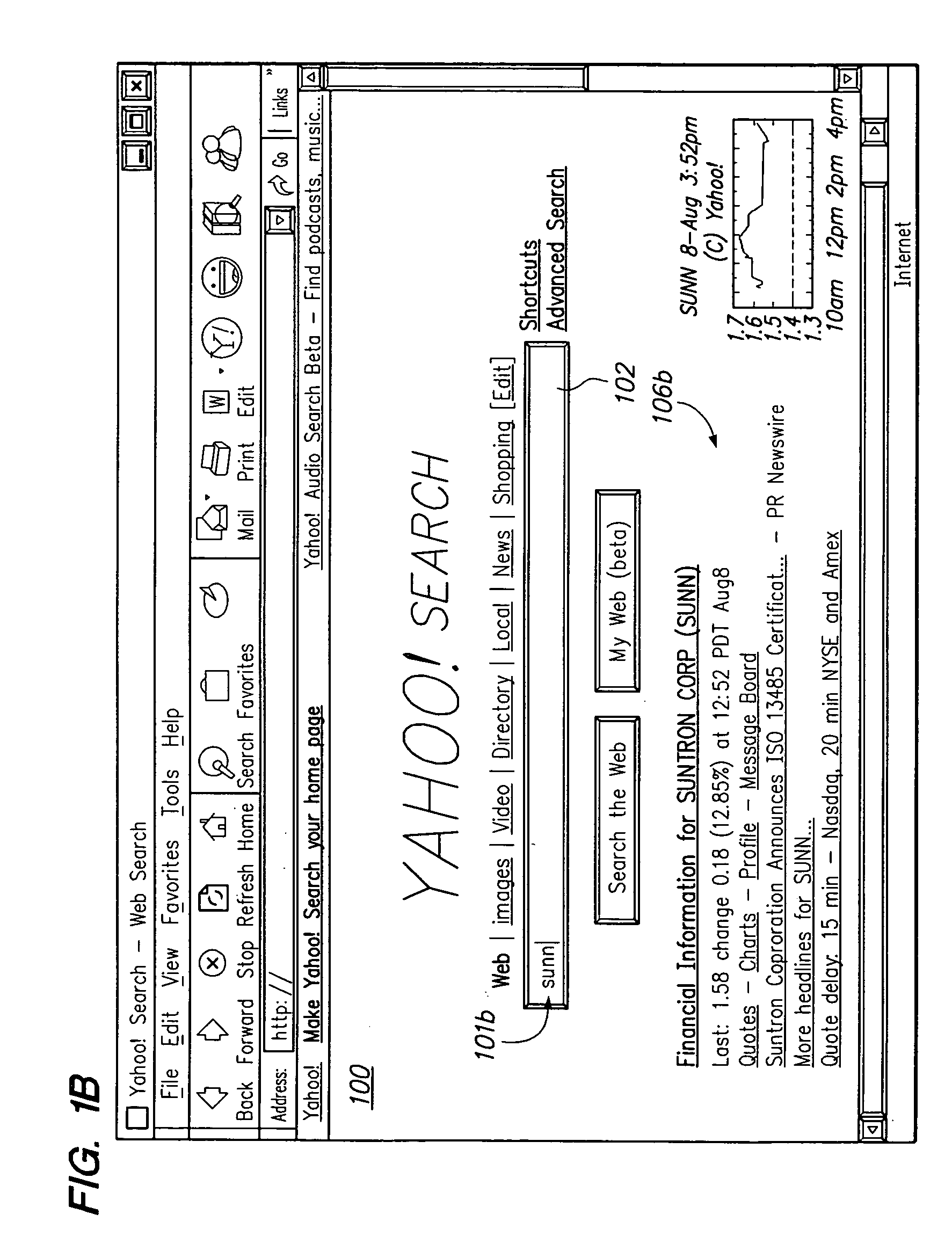

Biasing queries to determine suggested queries

ActiveUS20070050339A1Digital data information retrievalDigital data processing detailsTime deviationMachine learning

Owner:JOLLIFY MANAGEMENT

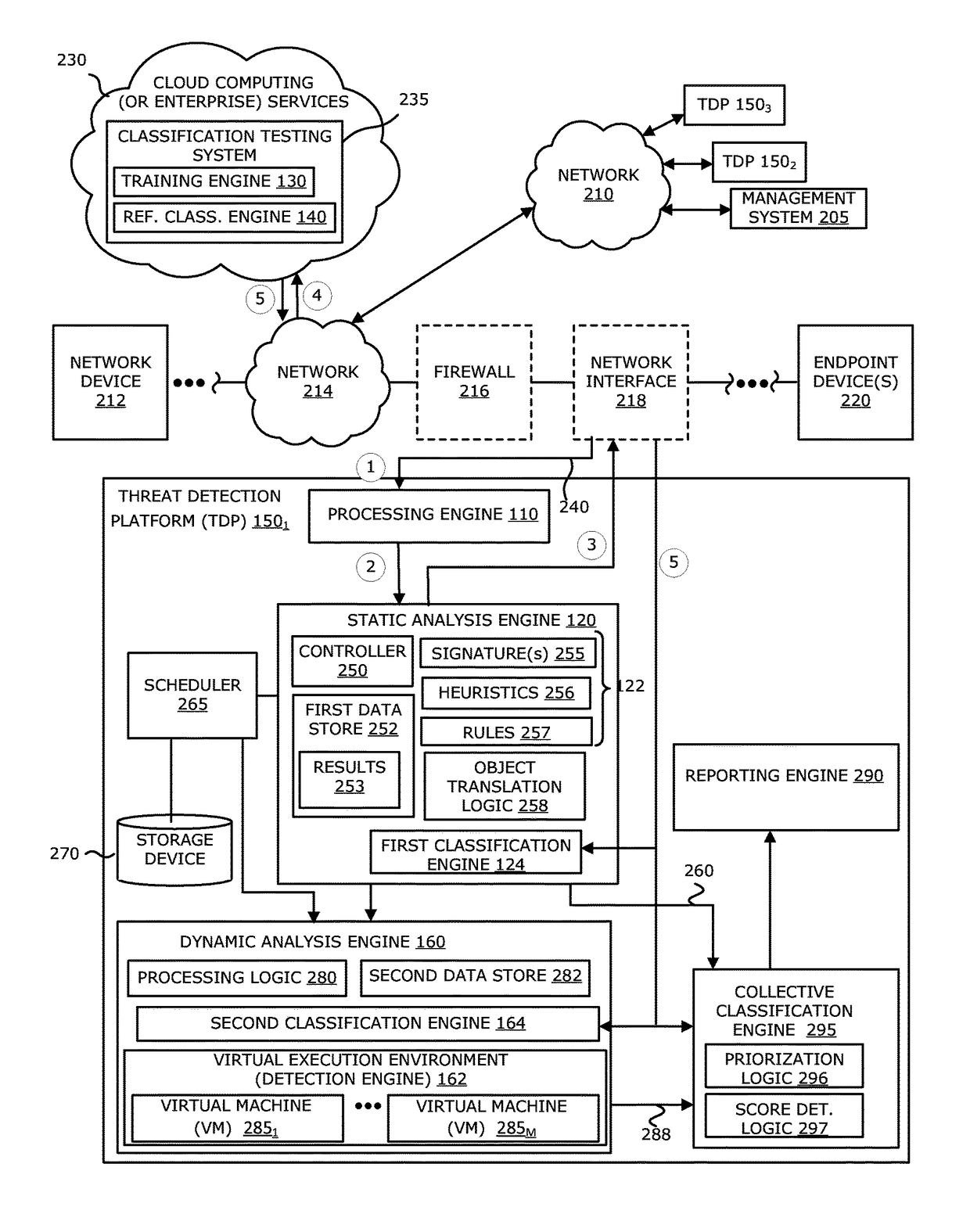

Framework for classifying an object as malicious with machine learning for deploying updated predictive models

ActiveUS9690933B1Easy to operateAccurate classificationPlatform integrity maintainanceKnowledge representationEngineeringArtificial intelligence

Owner:MANDIANT +1

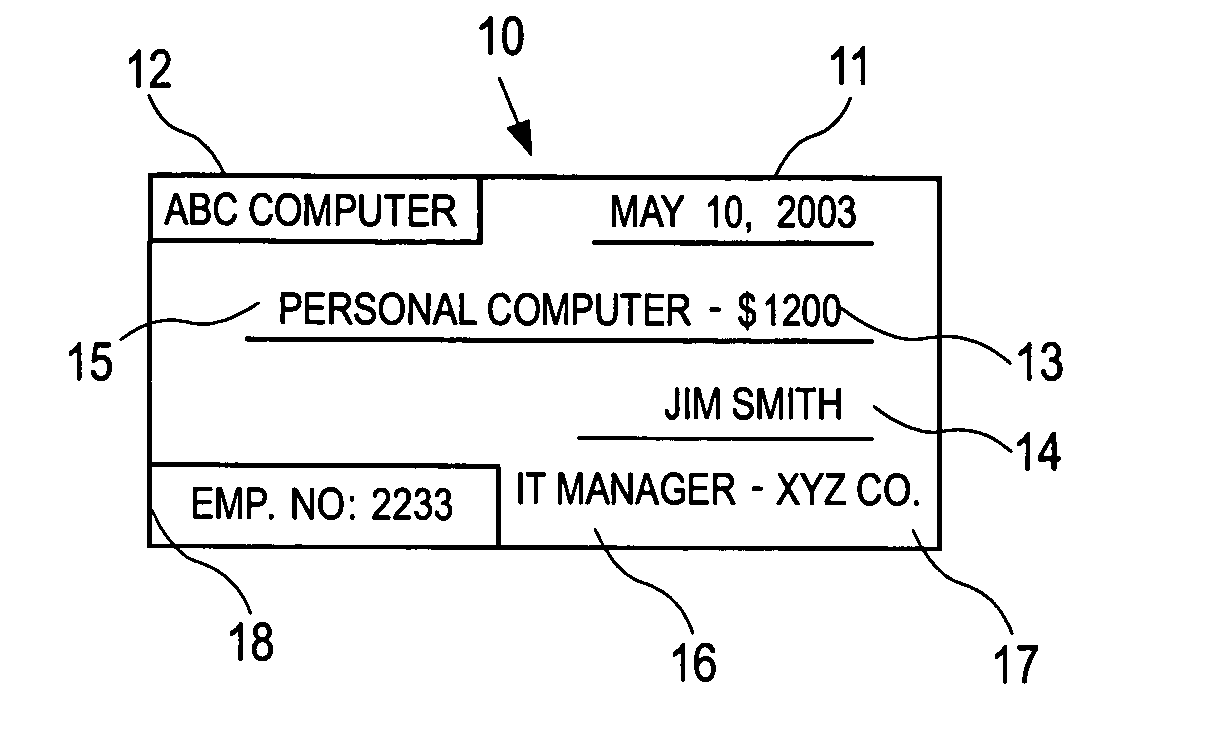

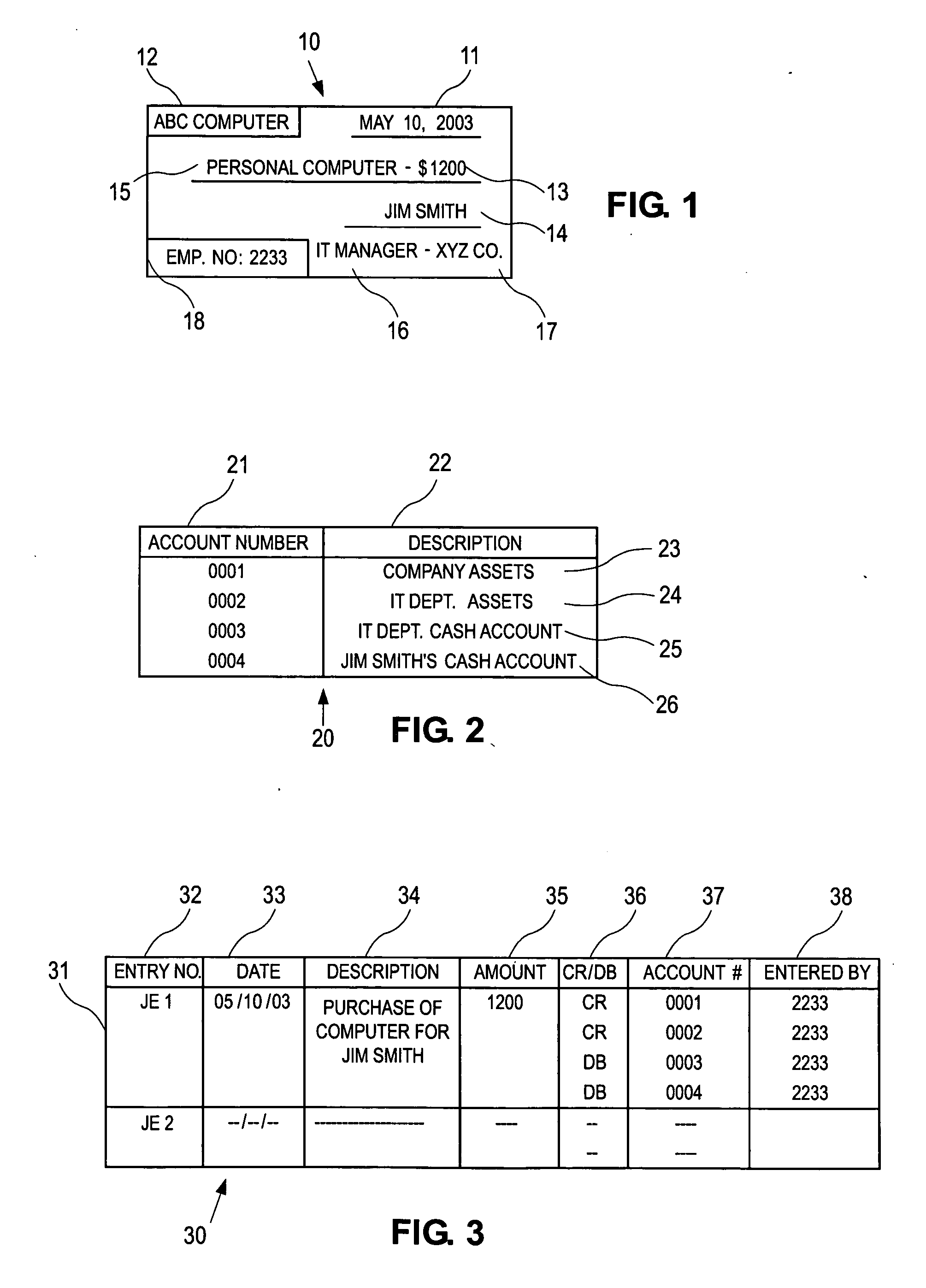

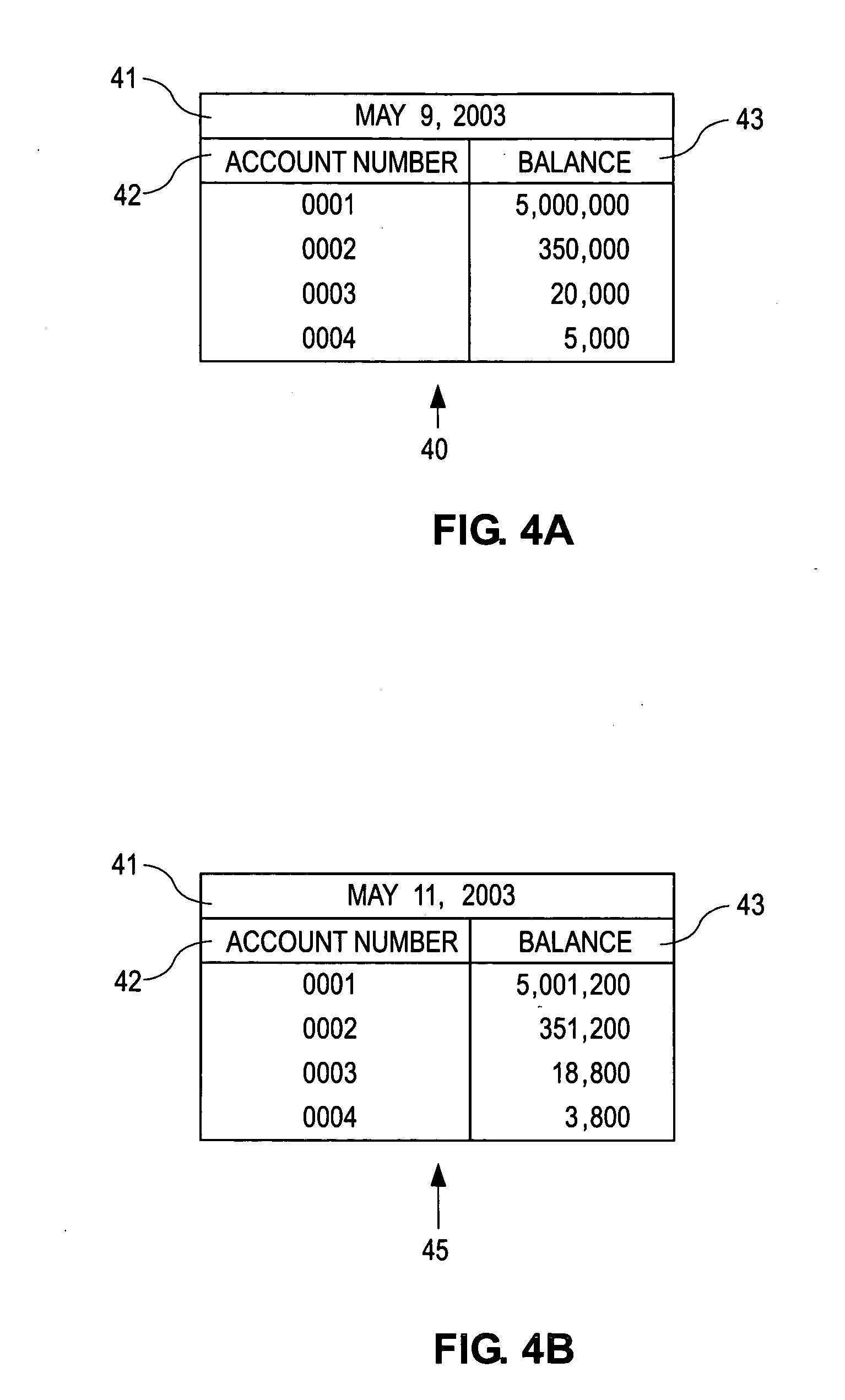

Multiple account preset parameter method, apparatus and systems for financial transactions and accounts

InactiveUS20060259390A1Increased riskEasy to chargeFinanceDebit schemesFinancial transactionSmart card

Methods, apparatus and systems are provided that enables at least one debit for a financial transaction and account management features using at least two financial accounts from which such debits and / or credits can be made from said at least two financial accounts using preset financial account parameters including, but not limited to, at least one ratio, an amount threshold, a remainder threshold, a minimum available account balance, a maximum available account balance, a minimum debit amount, a range of debit amounts, a maximum debit amount, a qualitative or quantitative aspect of at least one said financial accounts, or any combination thereof, and / or other parameters, such as, but not limited to at least one threshold amount and / or remainder amount. The transaction processor also allows account debiting or account crediting parameters to be set in accordance to any merchant identifier information, and permits account balances used for a given transaction to be readjusted after said transaction has been posted. A smart card or personal identification systems embodiment of the transaction processor comprising certain capabilities of the global financial card account embodiment is also provided.

Owner:ROSENBERGER RONALD J

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com