Patents

Literature

454results about "Debit schemes" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

Authenticating Wireless Person-to-Person Money Transfers

InactiveUS20070255662A1Facilitates manualFacilitates automated load functionalityDebit schemesLock-out/secrecy provisionWireless transmissionComputer science

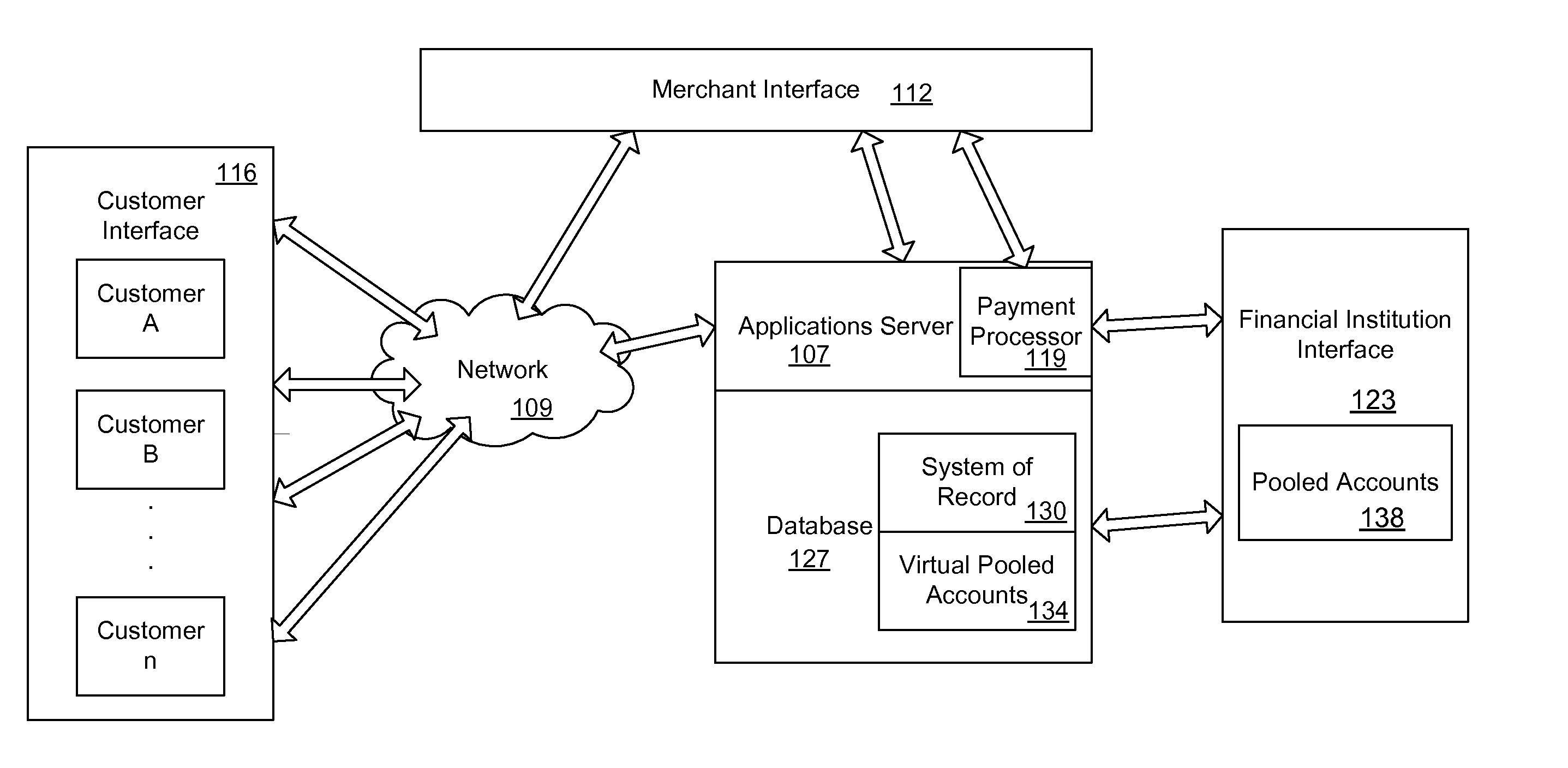

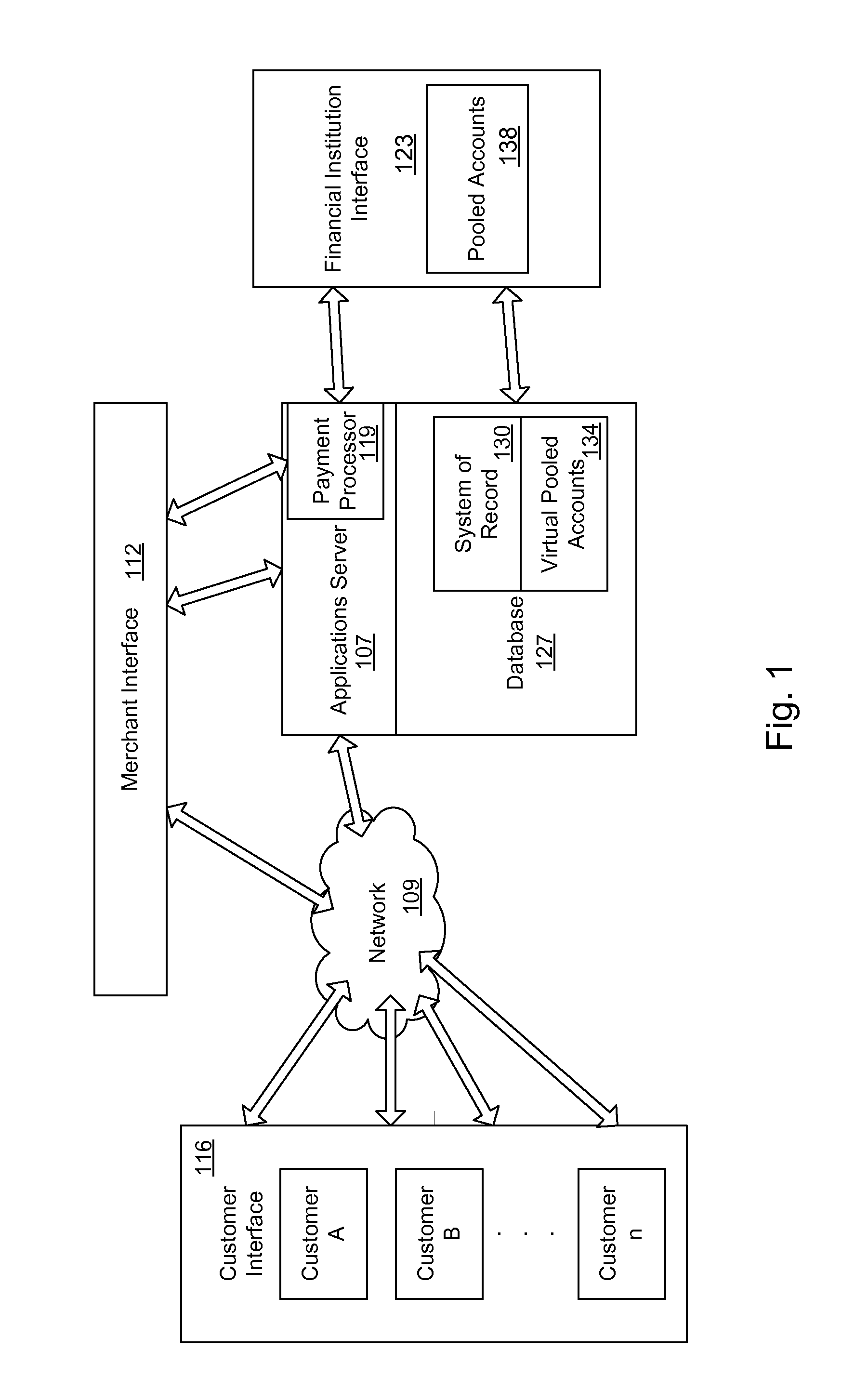

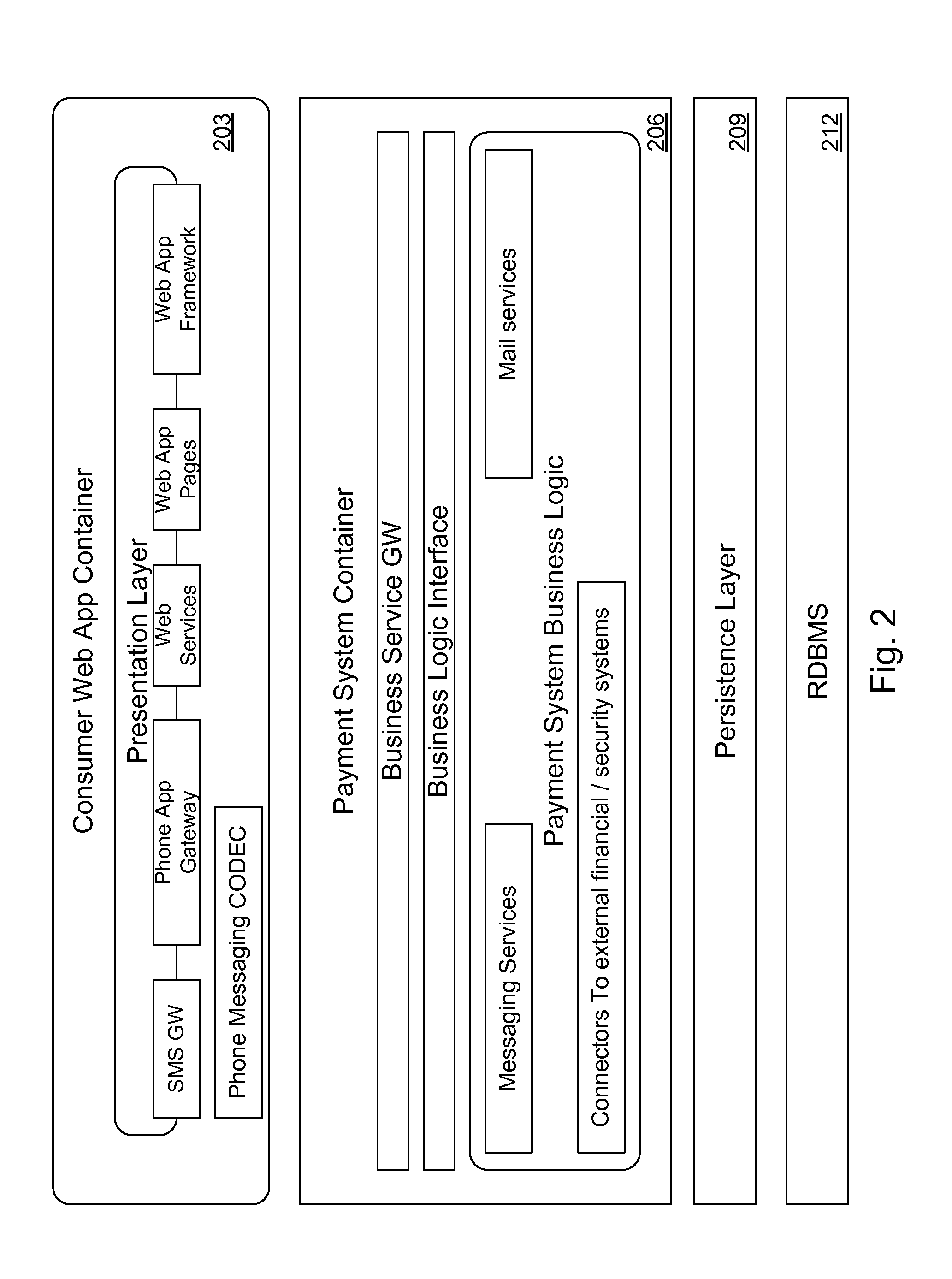

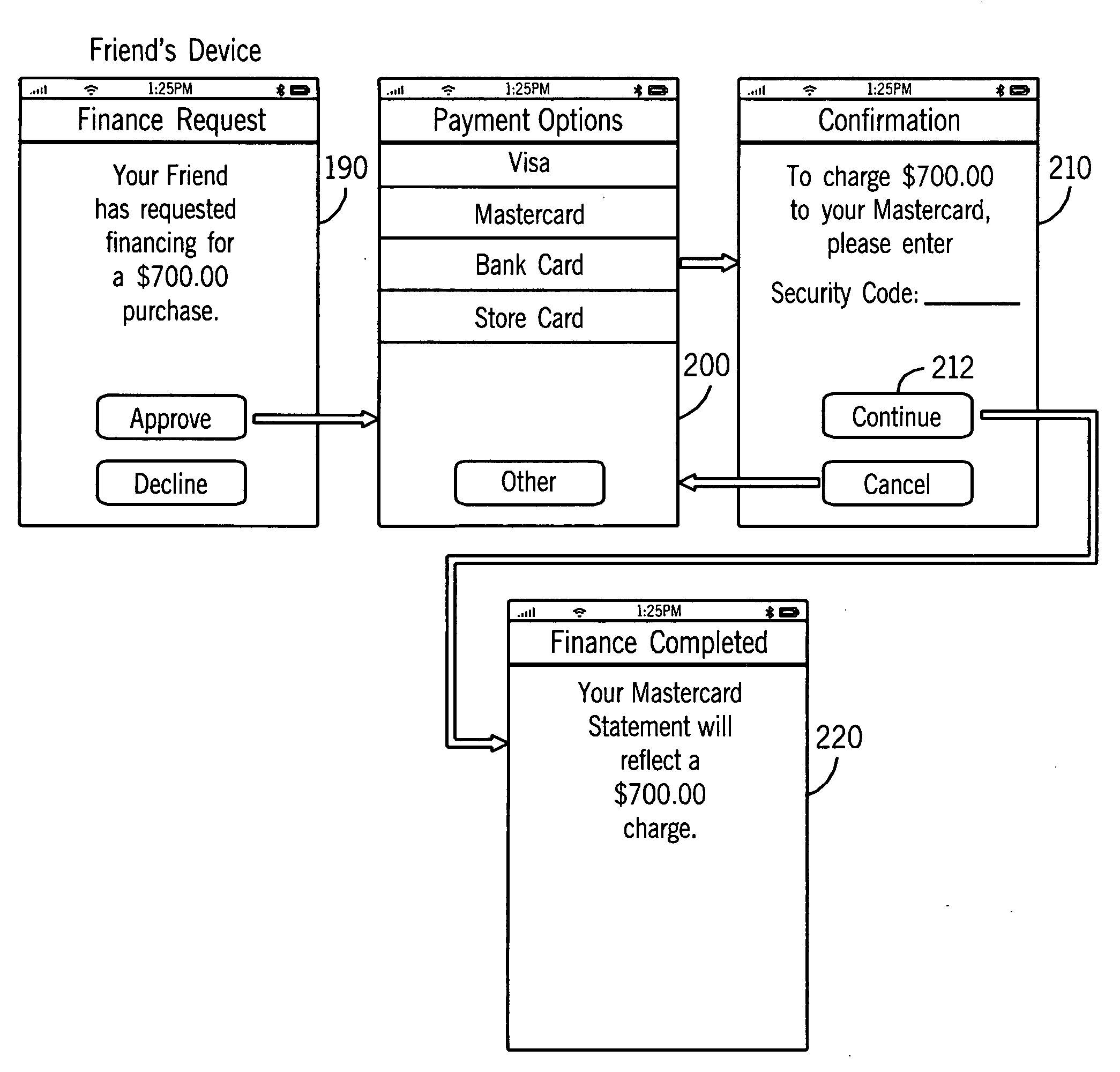

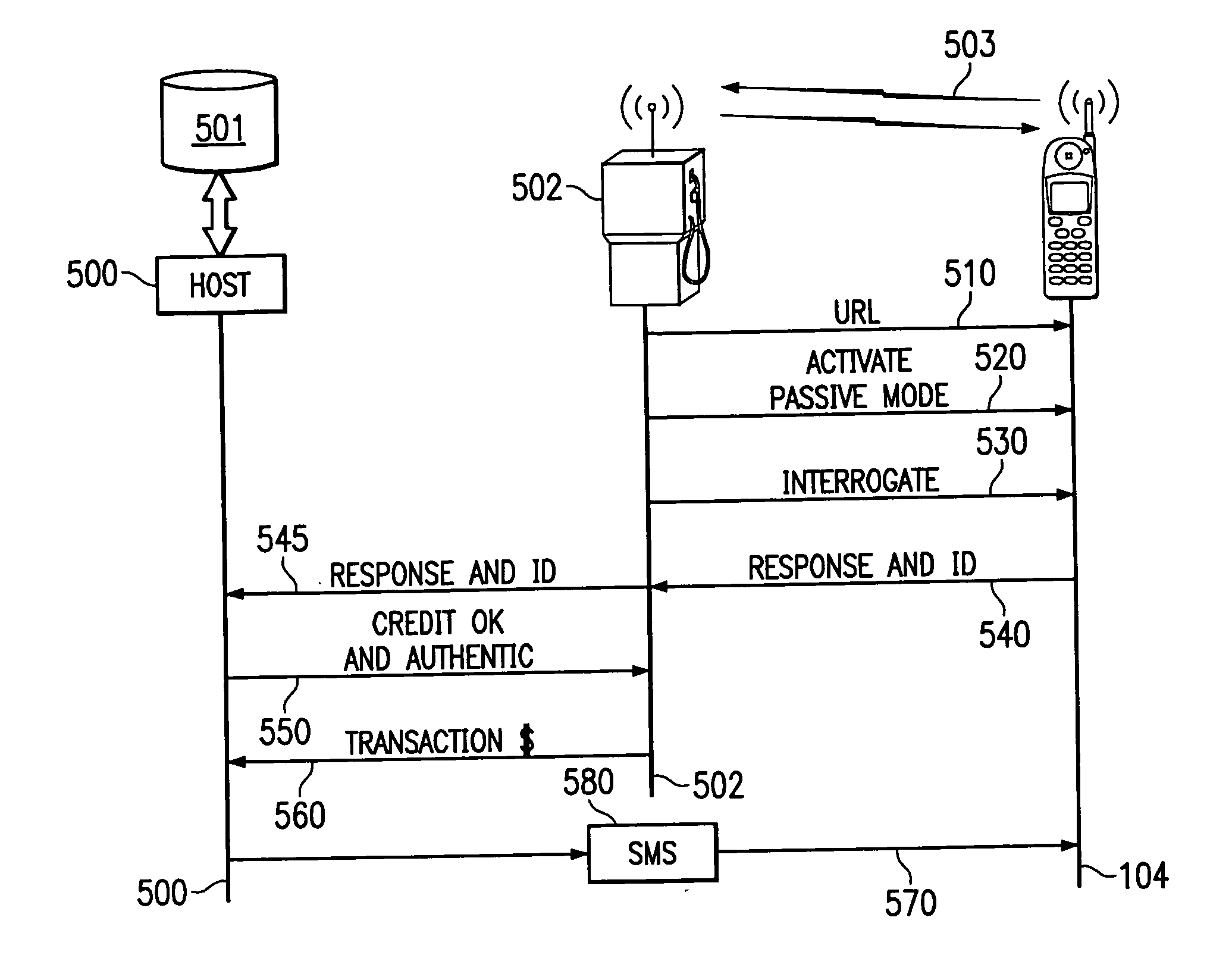

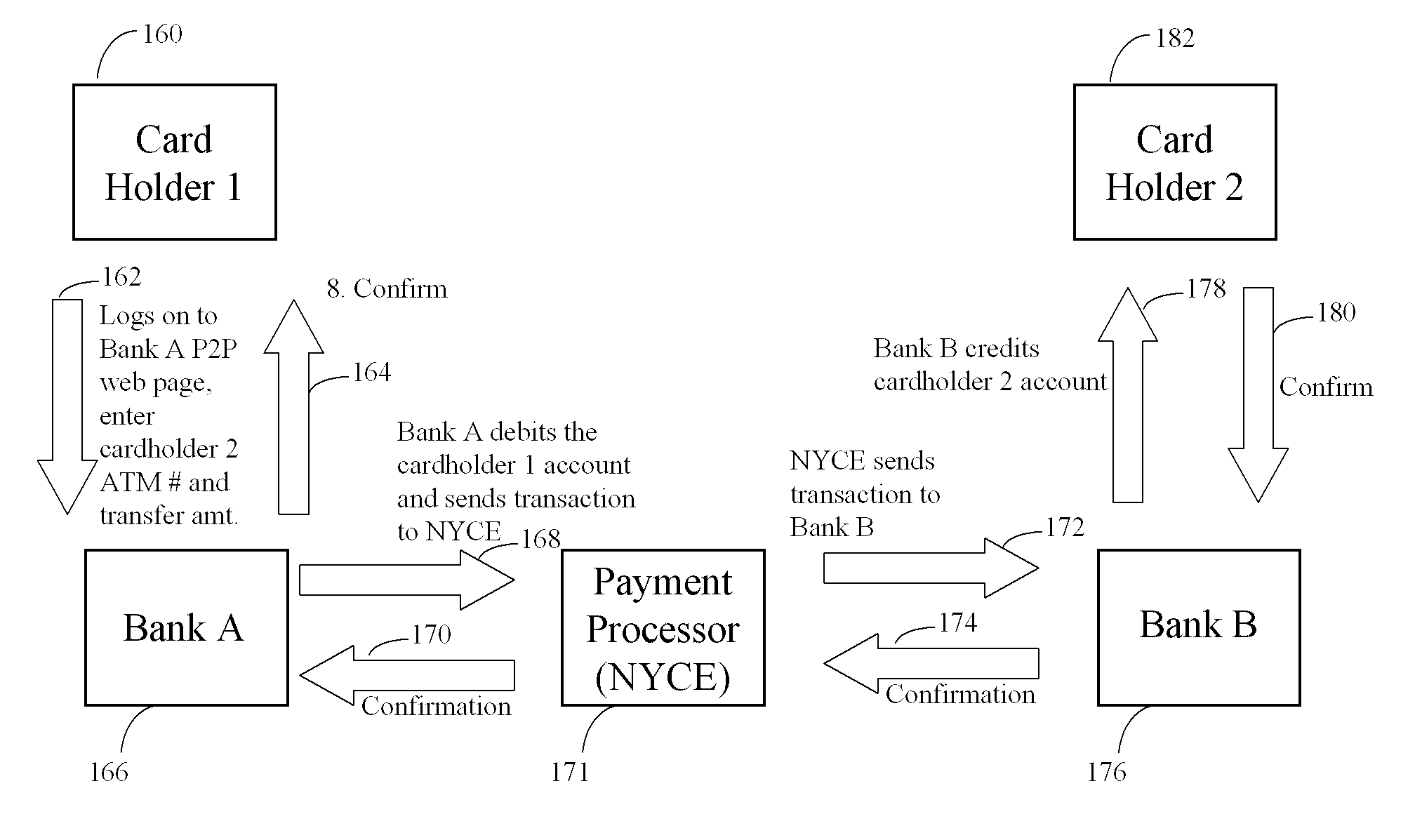

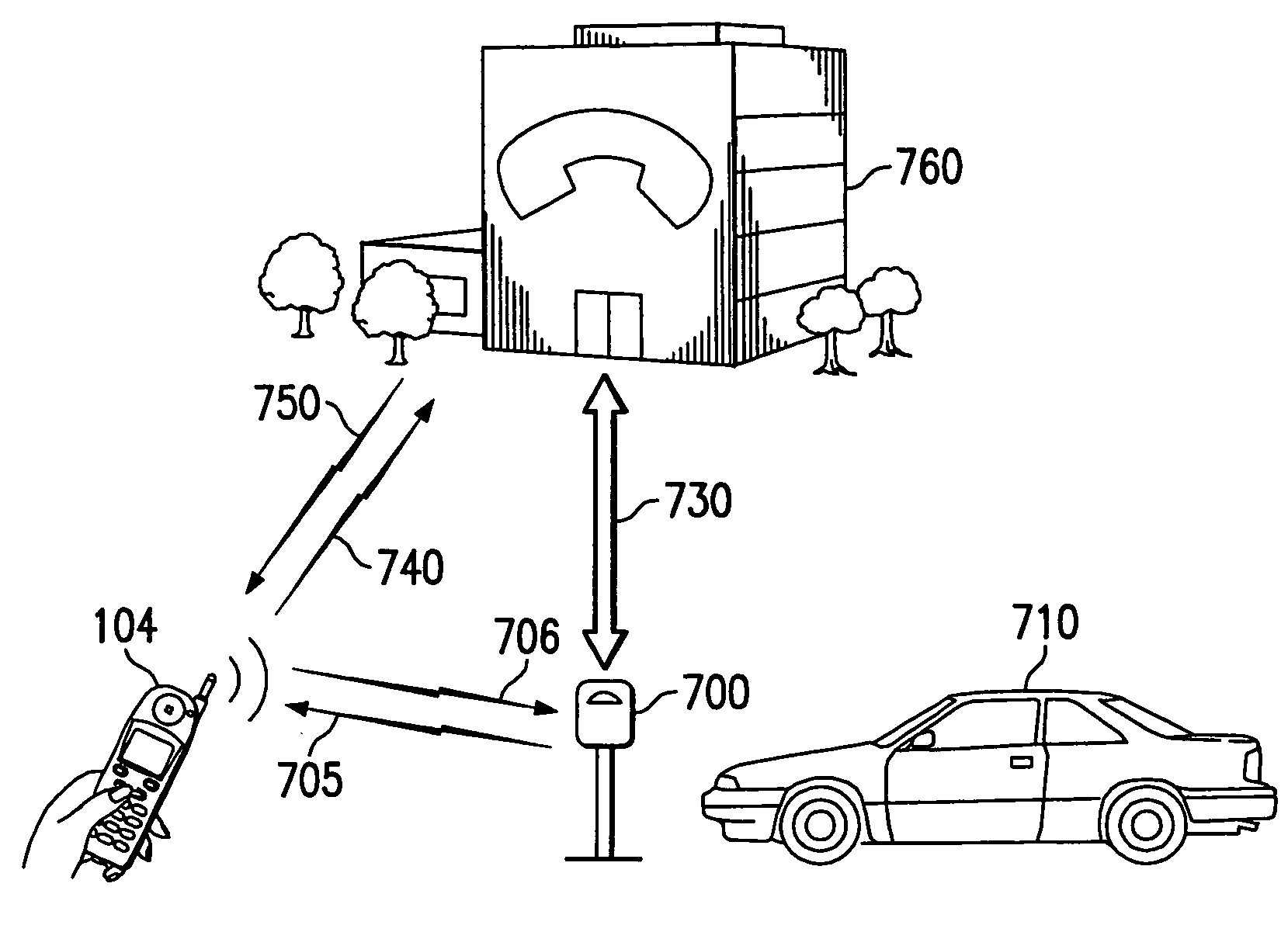

A technique is used to ensure the authenticity of a wireless transmission source which is requesting a transaction to be performed by a system. The transaction may be a person-to-person money transfer or other value exchange transaction. The wireless transmission source may be a mobile phone or other similar device. The wireless transmission source transmits a key with the transaction request. The system will determine the authenticity of the transmission based on the transmitted key. If the transmission is determined to be authentic, the transaction will be acted upon. Various approaches for determining authenticity are discussed. The technique may also be used to prevent acting upon duplicate transmissions.

Owner:OBOPAY MOBILE TECH INDIA PTE LTD

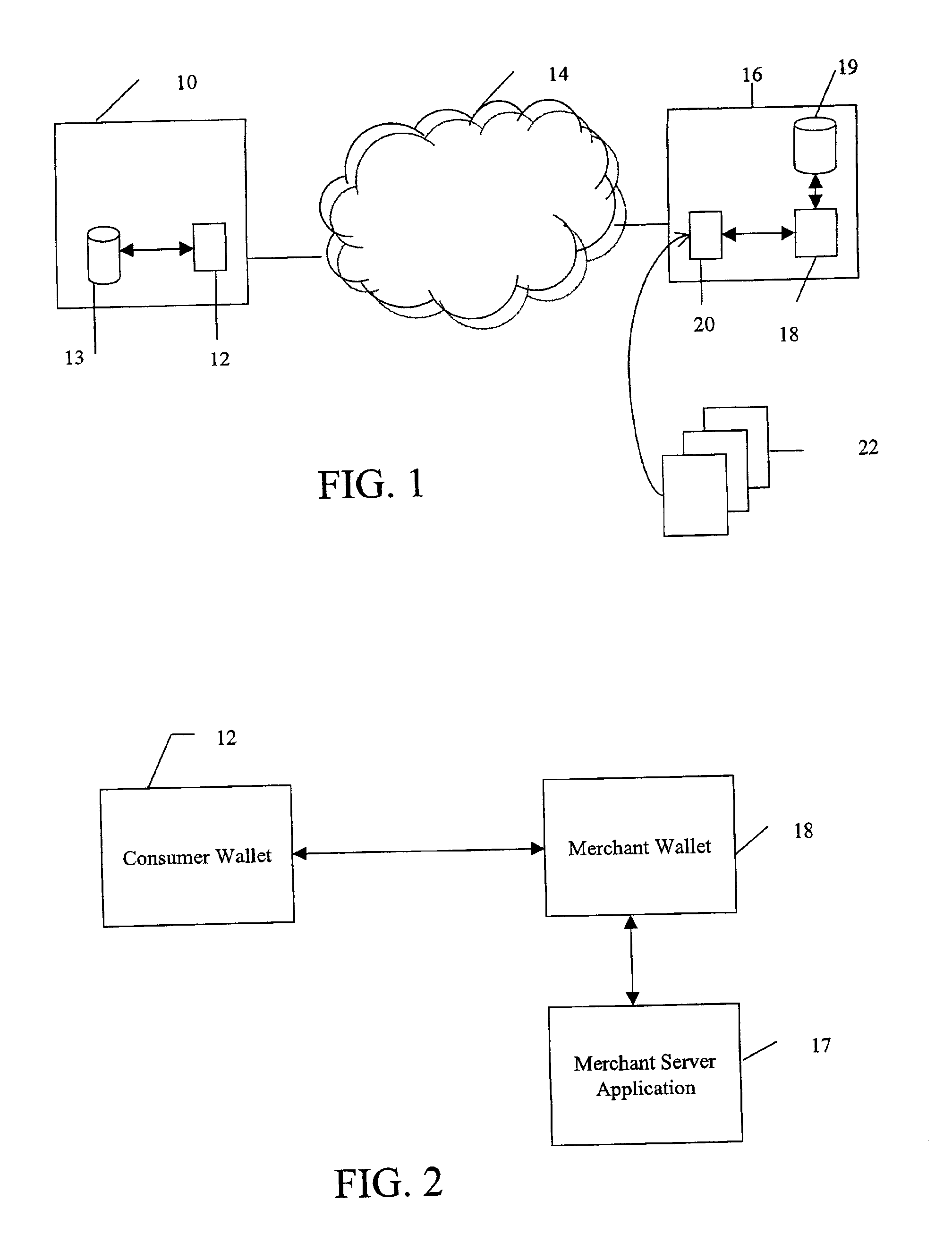

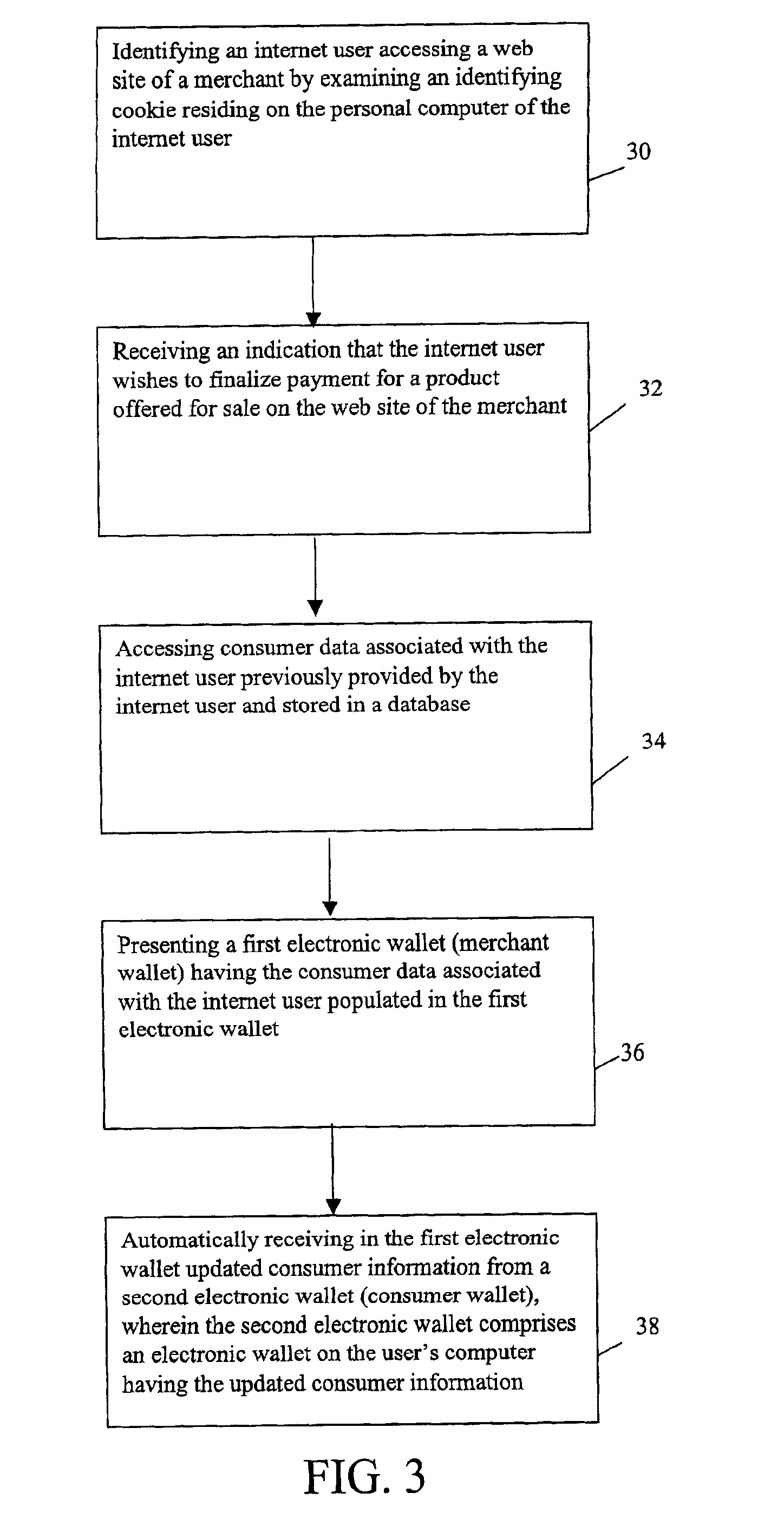

System and method for use of distributed electronic wallets

InactiveUS6873974B1Avoid burdenImprove efficiencyComplete banking machinesFinanceMerchant servicesCredit card

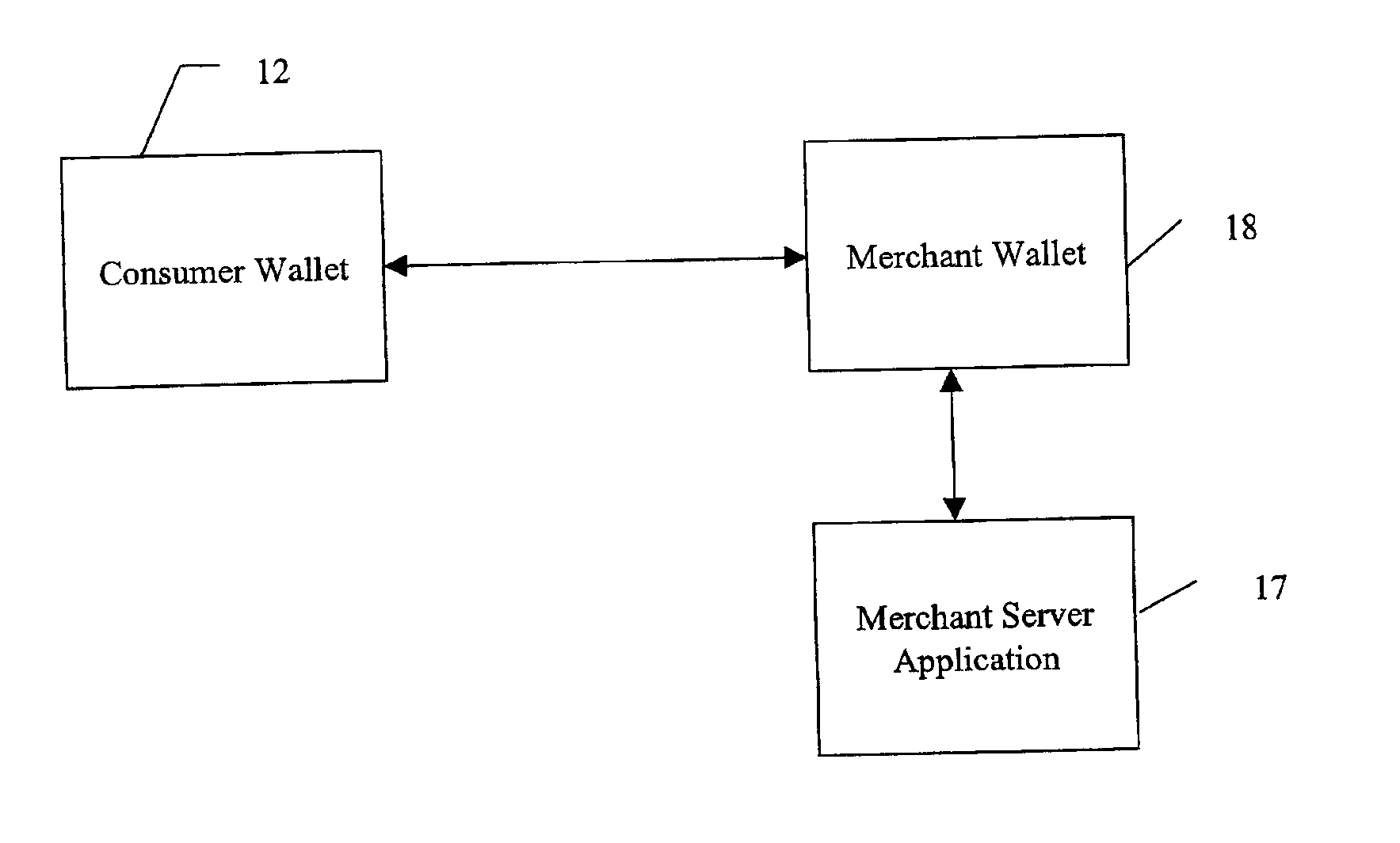

Methods and systems whereby two electronic wallets communicate and exchange information. In one such system, a consumer's personal electronic wallet communicates with the exclusive or preferred wallet of a web merchant. In one such system, an internet consumer registers with a web merchant's exclusive or preferred electronic wallet (“merchant wallet”) and provides consumer information (e.g., credit card number, mailing address, and other information) to the merchant wallet, which is stored by the merchant wallet in a database on the merchant server. Such information may be automatically populated by the consumer's personal electronic wallet. The consumer maintains current consumer information in a consumer electronic wallet on the consumer's personal computer. When the consumer visits the merchant site again, and orders goods or services, the merchant's preferred wallet can be automatically updated by the consumer's electronic wallet if any of the data in the merchant's wallet has changed. For example, the consumer wallet examines the information in the merchant wallet to determine if the information in the merchant wallet conforms to the current information in the consumer wallet. If the information does not conform, the consumer wallet communicates the current consumer information to the merchant wallet.

Owner:CITIBANK

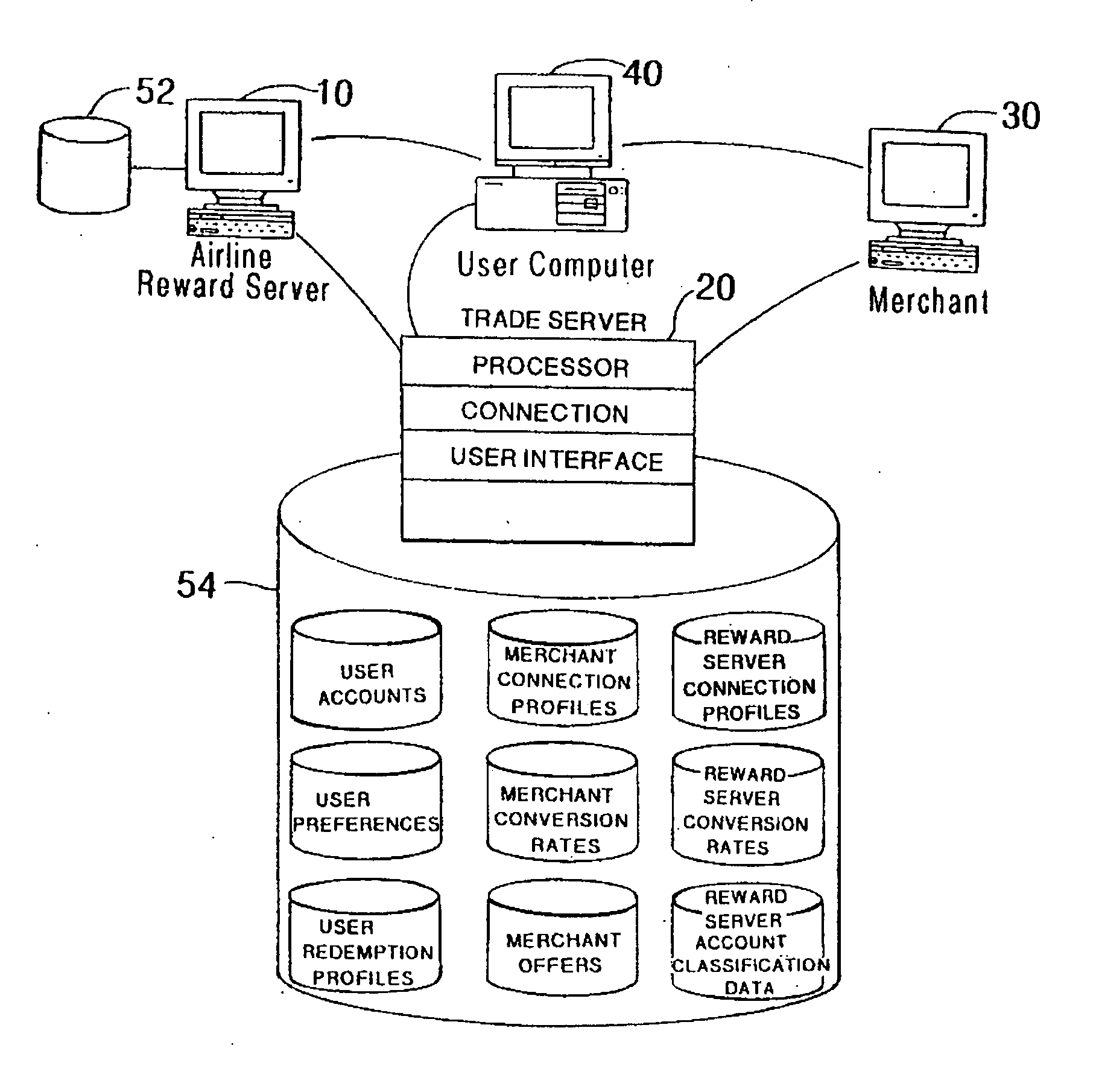

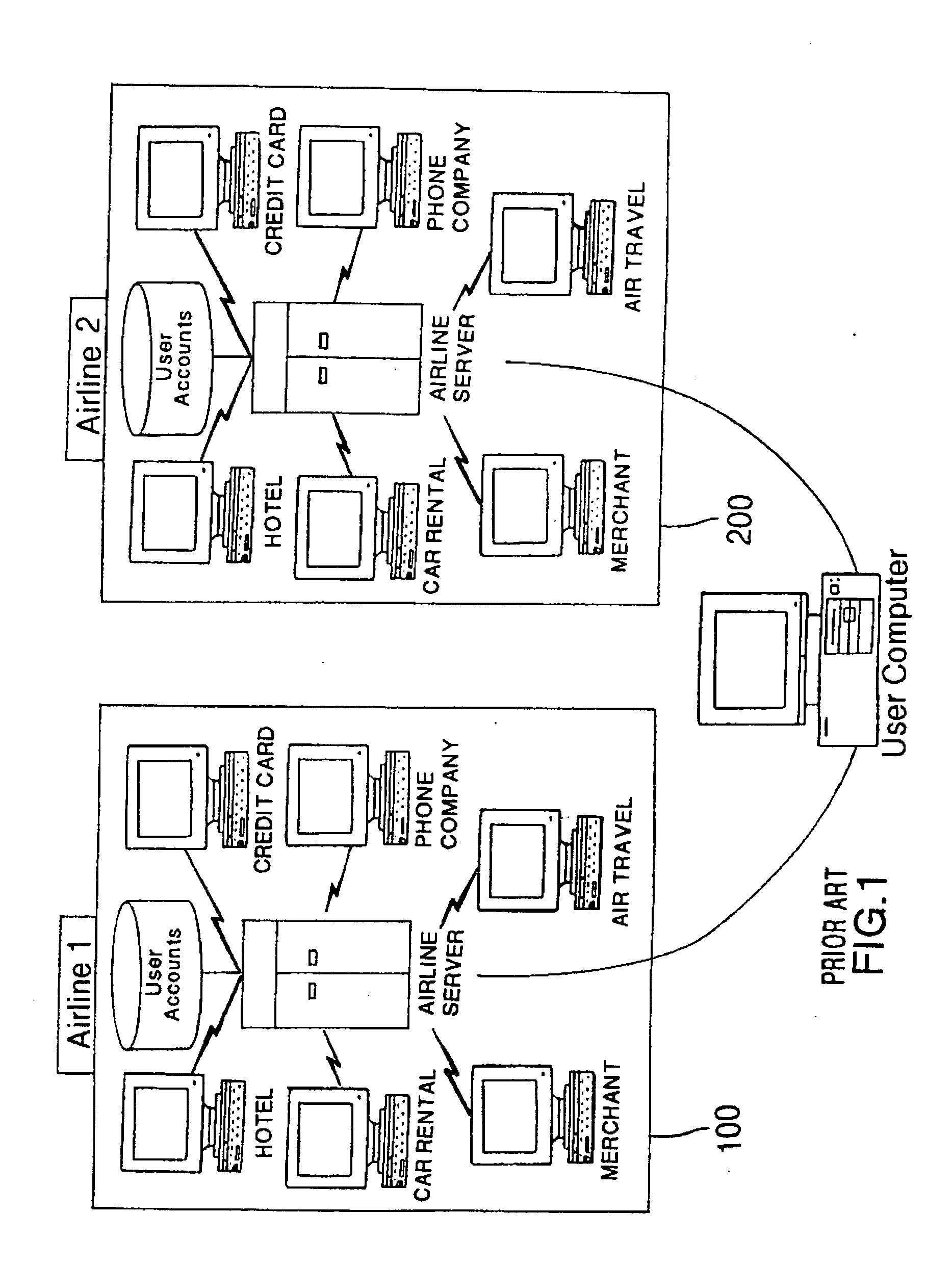

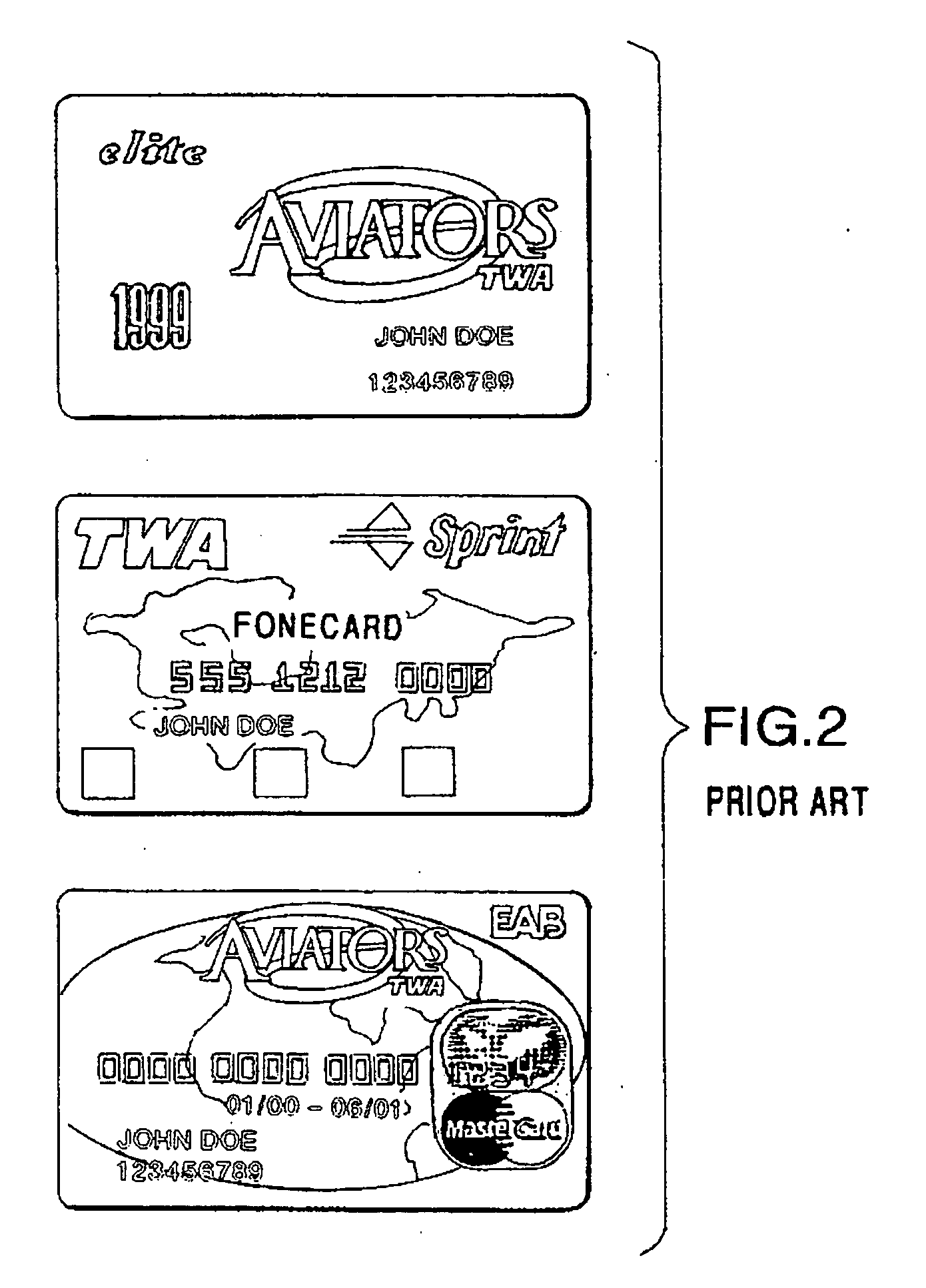

Method and system for using multi-function cards for storing, managing and aggregating reward points

InactiveUS20050021400A1Decreasing (if not eliminating) reliance on a central server systemDiscounts/incentivesFinanceCredit cardMultimedia

A system and method for operating a reward points accumulation and redemption program wherein a user earns reward points from a plurality of independent reward points issuing entities, with each tracking the user's earned reward points in a user reward point account stored on a multi-function card (such as a frequent flyer account or a credit card loyalty account). The multi-function card is adapted to aggregate some or all of the user's earned reward points from the reward accounts and credit the aggregated points into a single reward exchange account on the multi-function card. The user may then select an item for purchase with the accumulated reward points from the multi-function card. The item is provided to the user in exchange for a subset or all of the reward points from the multi-function card.

Owner:SIGNATURE SYST

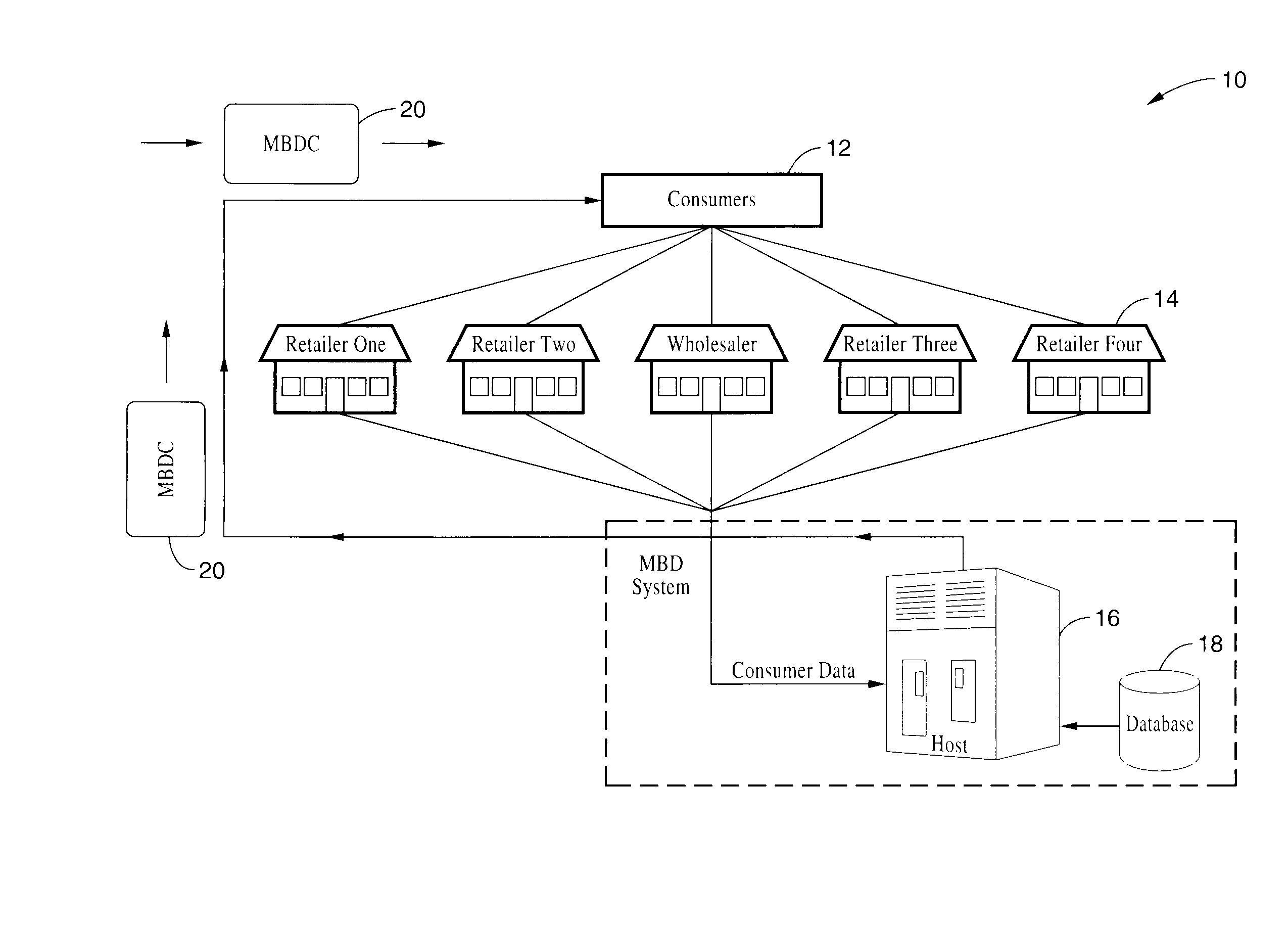

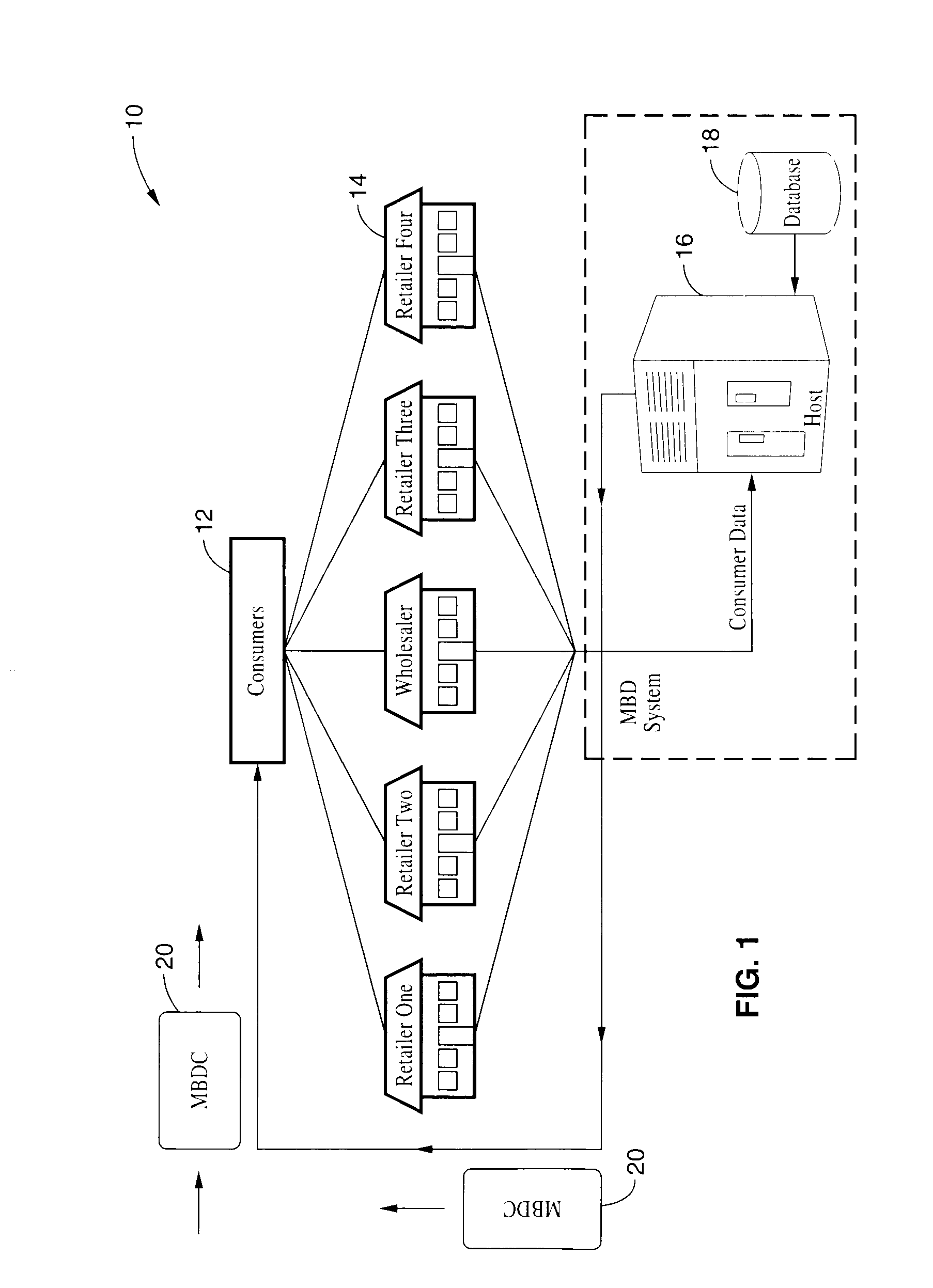

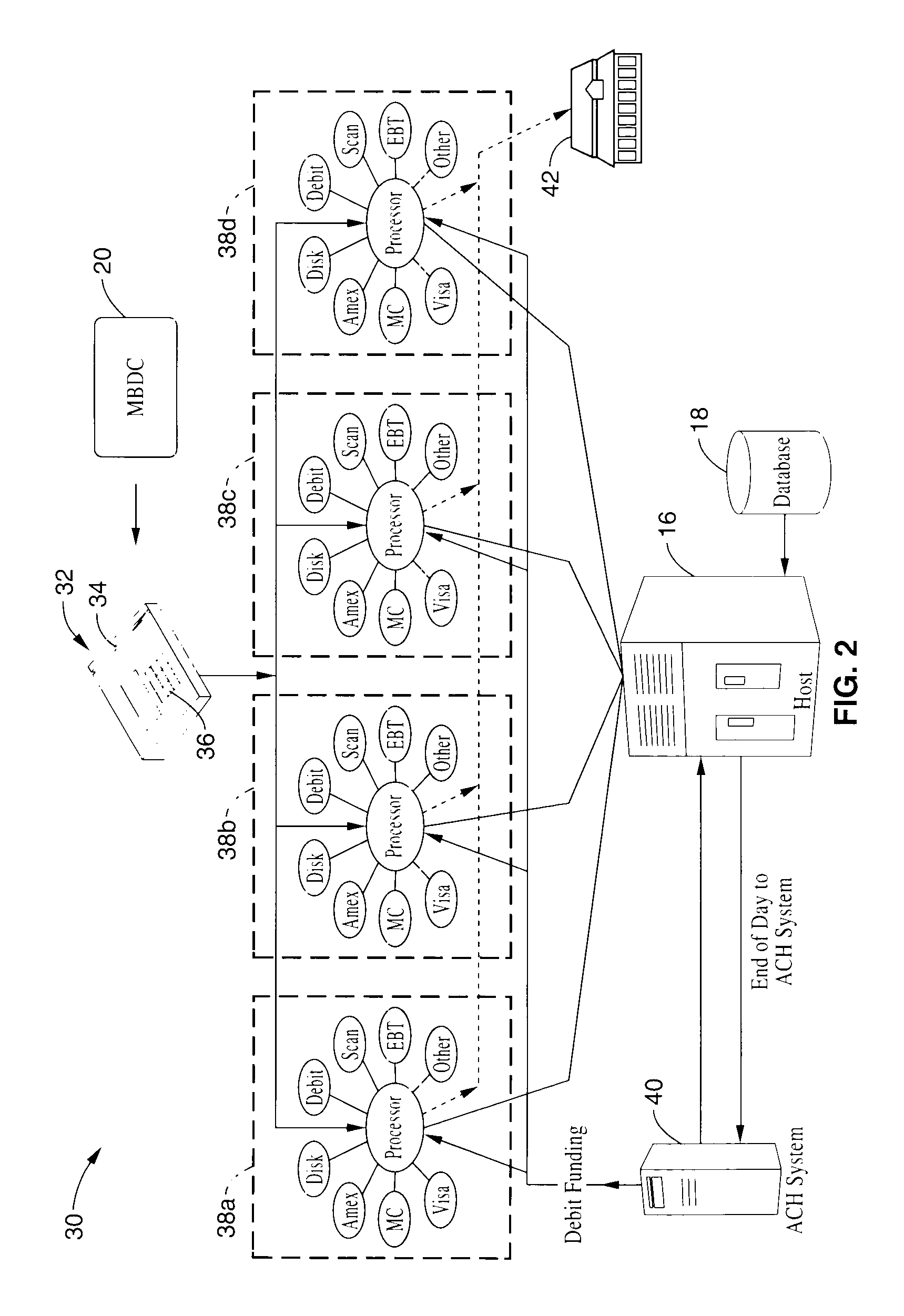

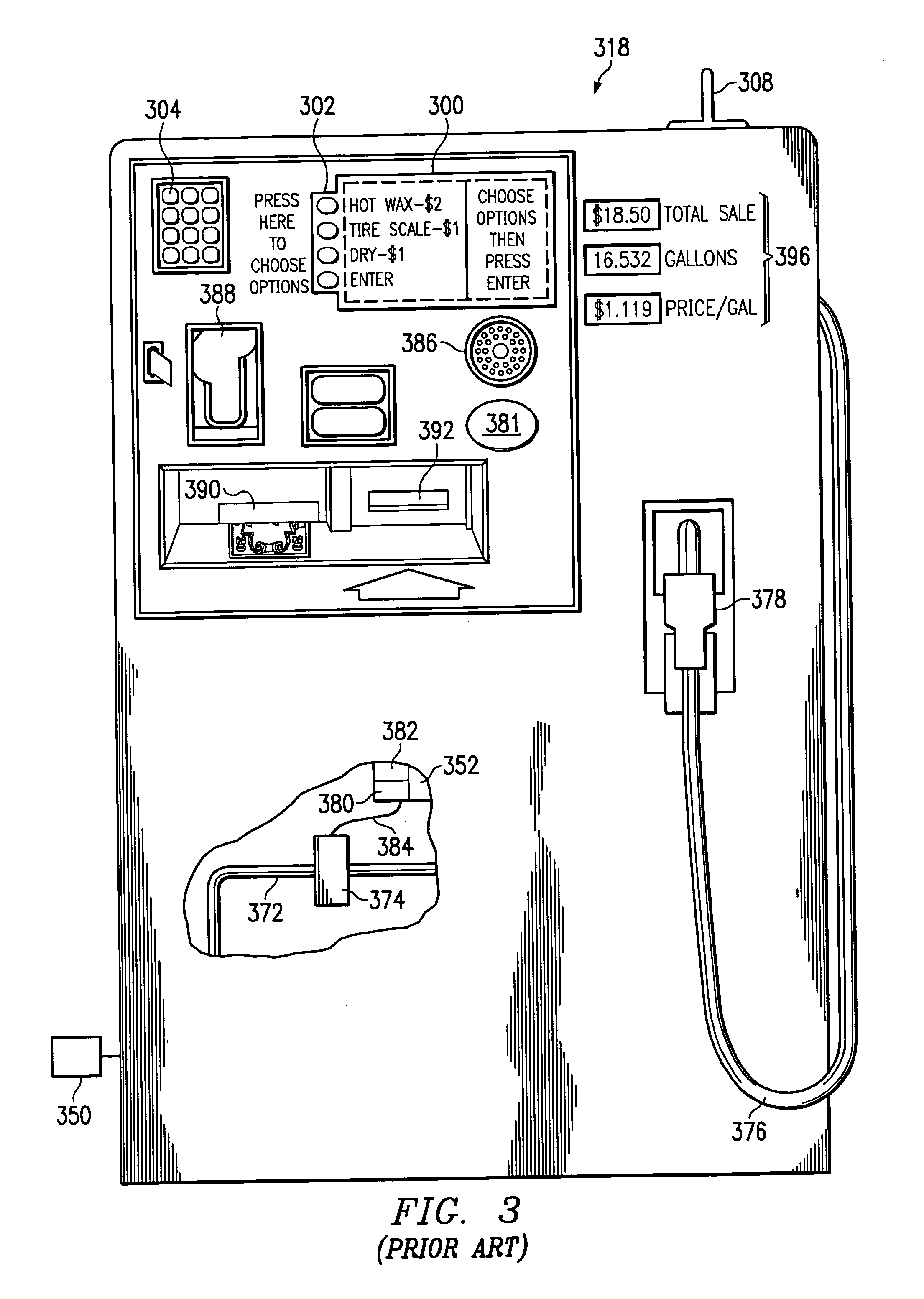

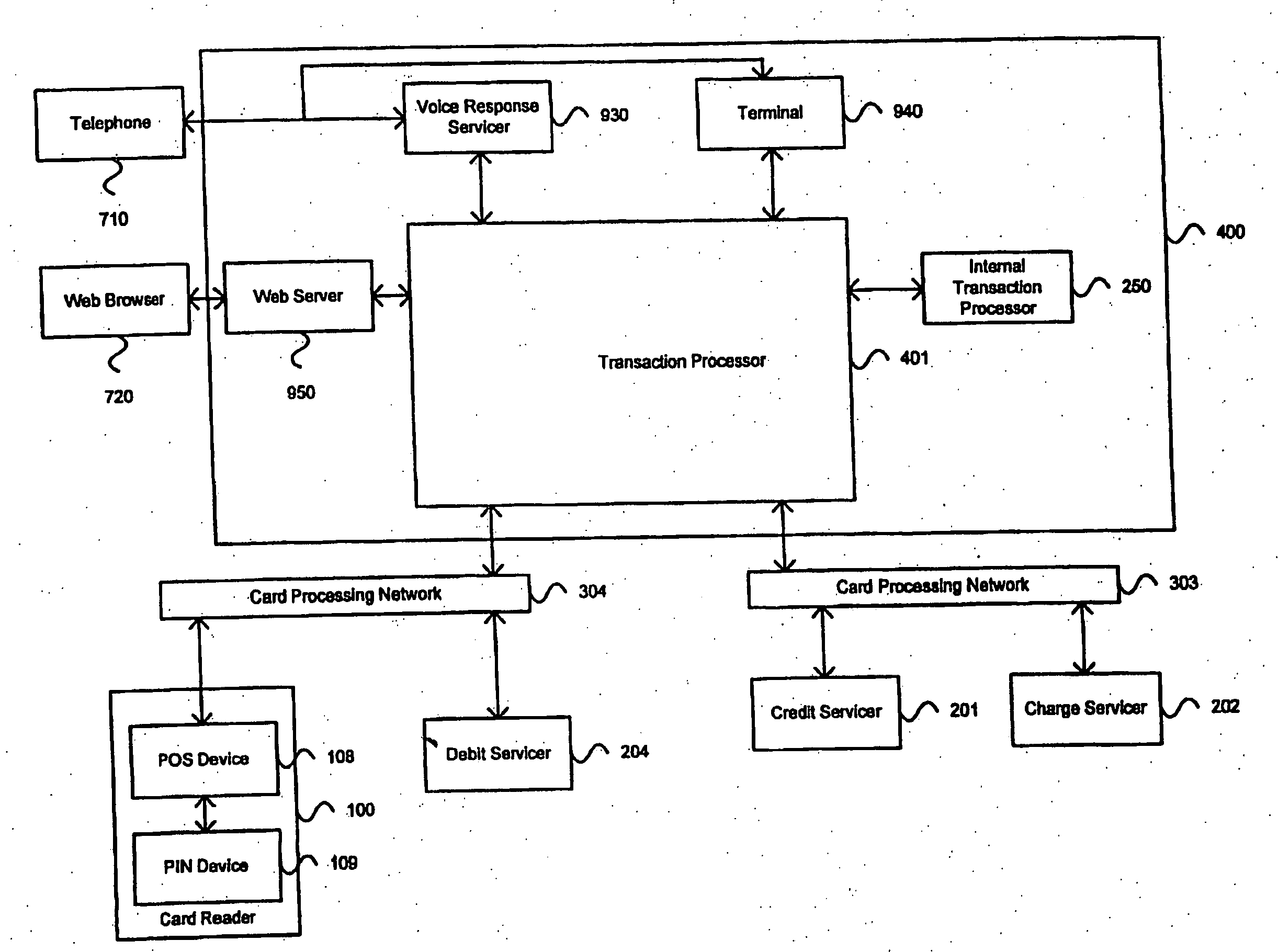

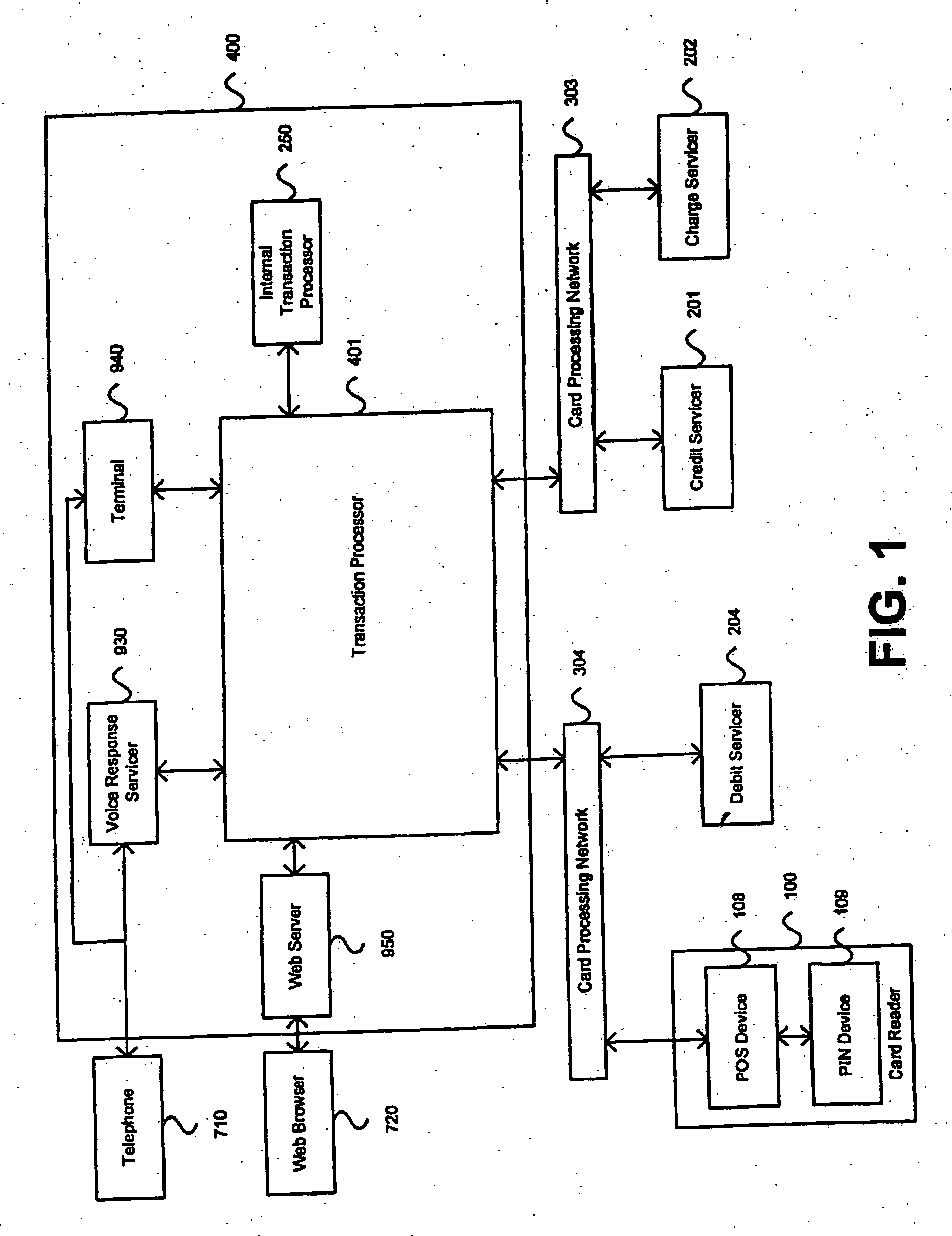

Method and system for facilitating electronic funds transactions

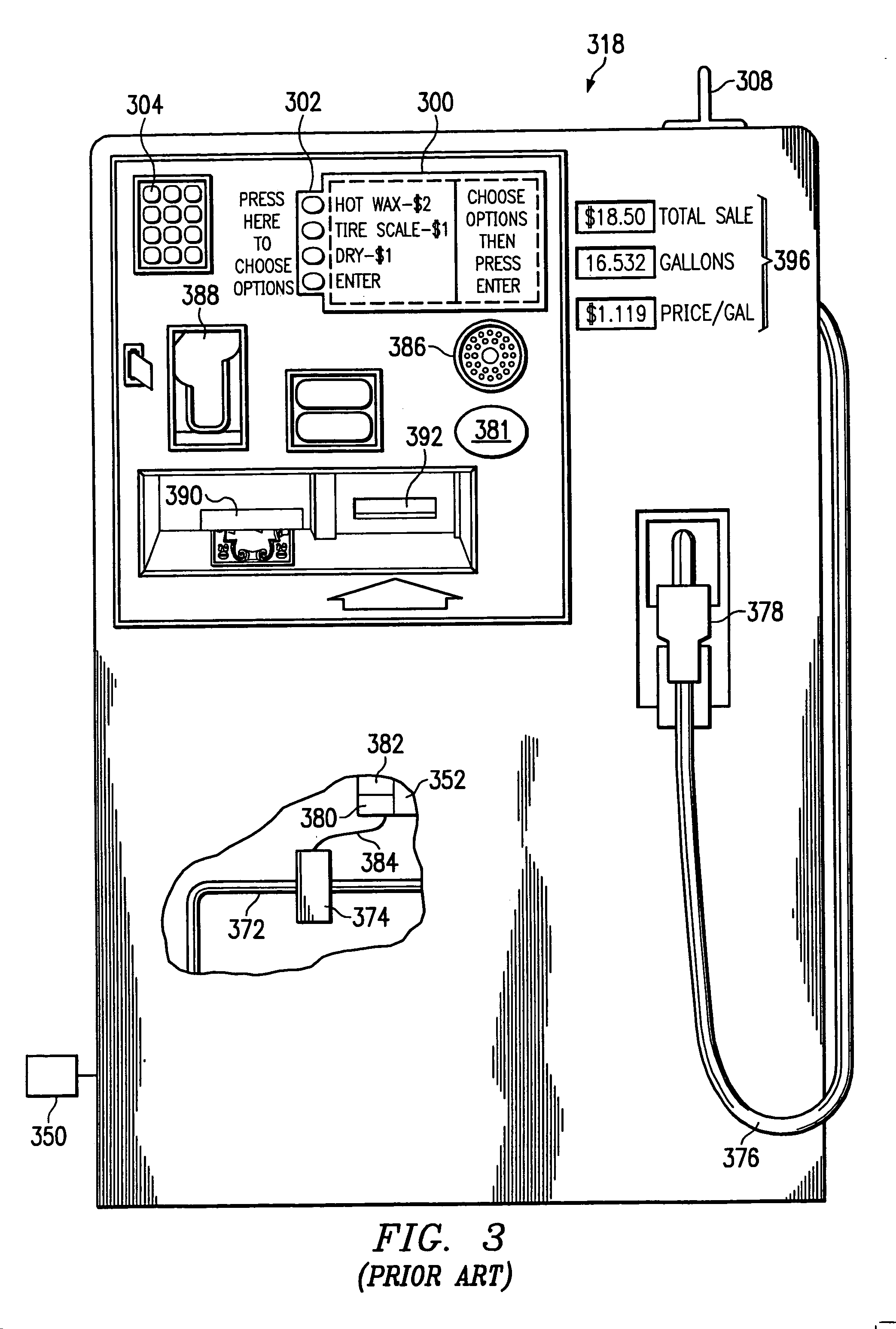

InactiveUS7104443B1Measurement is limitedReduce transaction costsComplete banking machinesFinanceInformation sharingMerchant account

A method and system for executing electronic funds transactions using a merchant based debit (MBD) card in a merchant-centric system that provides for reduced fees to acquiring merchants and remitting a portion of the collected fees to issuing merchants. The system also preferably provides information sharing on consumer transactions with merchants to facilitate consumer based incentive programs and the like. The system operates over conventional card processing infrastructure and utilizes the ACH network, or equivalent, to settle the transaction from a consumer checking account, or a merchant account in the case of a prepaid MBD card. Using the system, merchants may elect to qualify customers based on their own criterion. A portion of the interchange fee is distributed to the issuing merchant associated transaction executed using the merchant based debit card. Embodiments are described for prepaid, fixed value, programmable, and refillable, forms of merchant based debit cards.

Owner:KIOBA PROCESSING LLC

Smart menu options

InactiveUS20100082445A1Maximize the benefitsHand manipulated computer devicesFinanceContext basedHuman–computer interaction

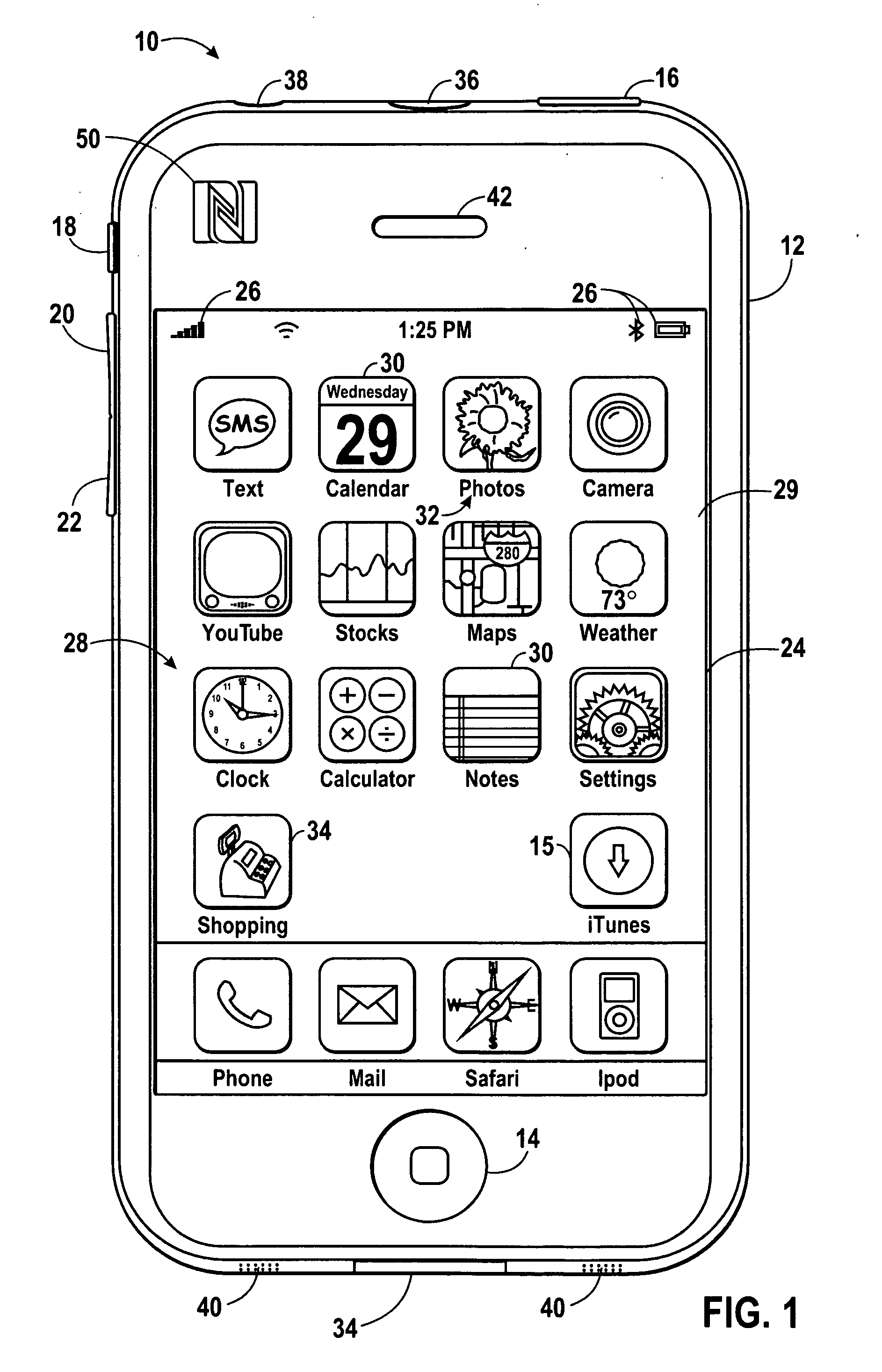

Systems and methods are provided that allow for a portable electronic device to provide smart menus to a user based on a context of a transaction. Specifically, the method of using a portable electronic device may include opening a near field communication (NFC) channel with a point-of-purchase device and providing a smart menu based on a determined context. The portable electronic device may be configured to determine the context based at least in part upon acquiring sales transaction information for the point-of-purchase device. Additionally, the portable electronic device may be configured to determine the context based at least in part upon acquiring vendor identification information.

Owner:APPLE INC

System and method of making payments using an electronic device cover with embedded transponder

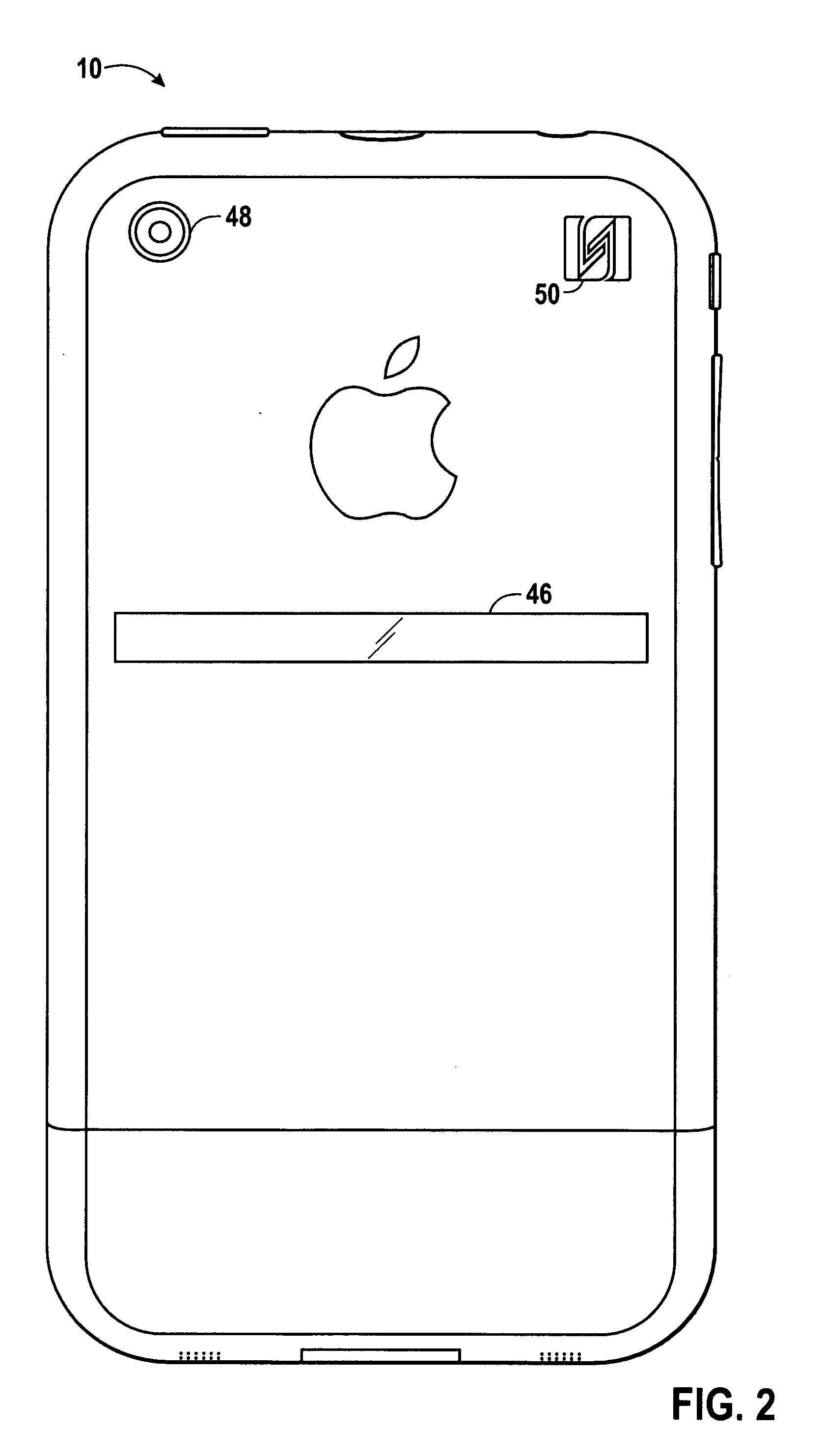

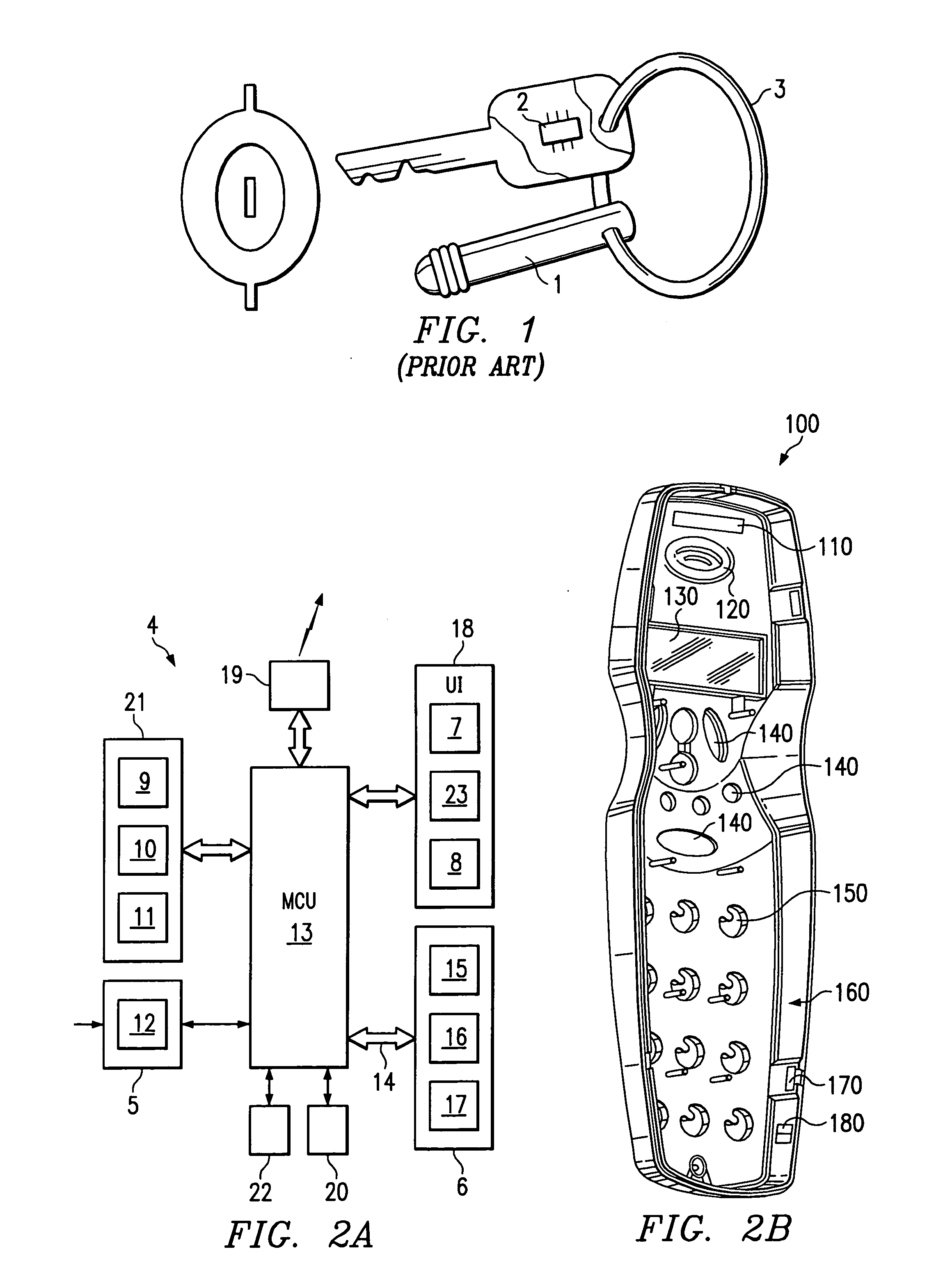

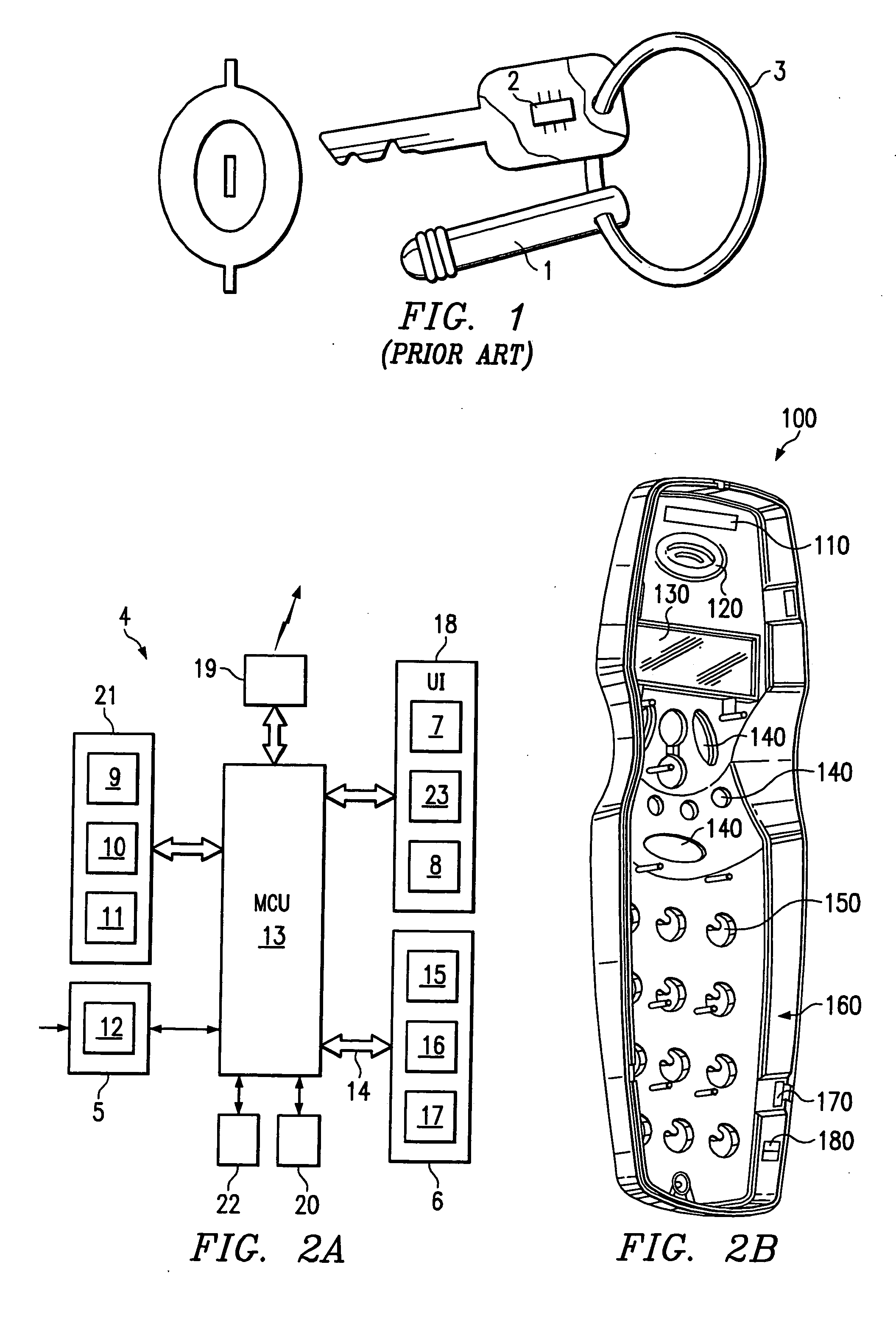

InactiveUS20050017068A1Improve standardsDevices with card reading facilityCash registersTransceiverElectronic identification

A changeable cover for an electronic device and method of using same in a payment system is provided. The cover has a transponder responsive to interrogation by an electric field. The cover provides an electronic identification number and other information in response to the interrogation signal. Also provided is a system for making payments, comprising at least one mobile station (4) which has an associated cover (100) for providing local data transfer. The system also comprises at least one point of sale terminal or the like, which has a second transceiver for providing data transfer.

Owner:RPX CORP

Persistent dynamic payment service

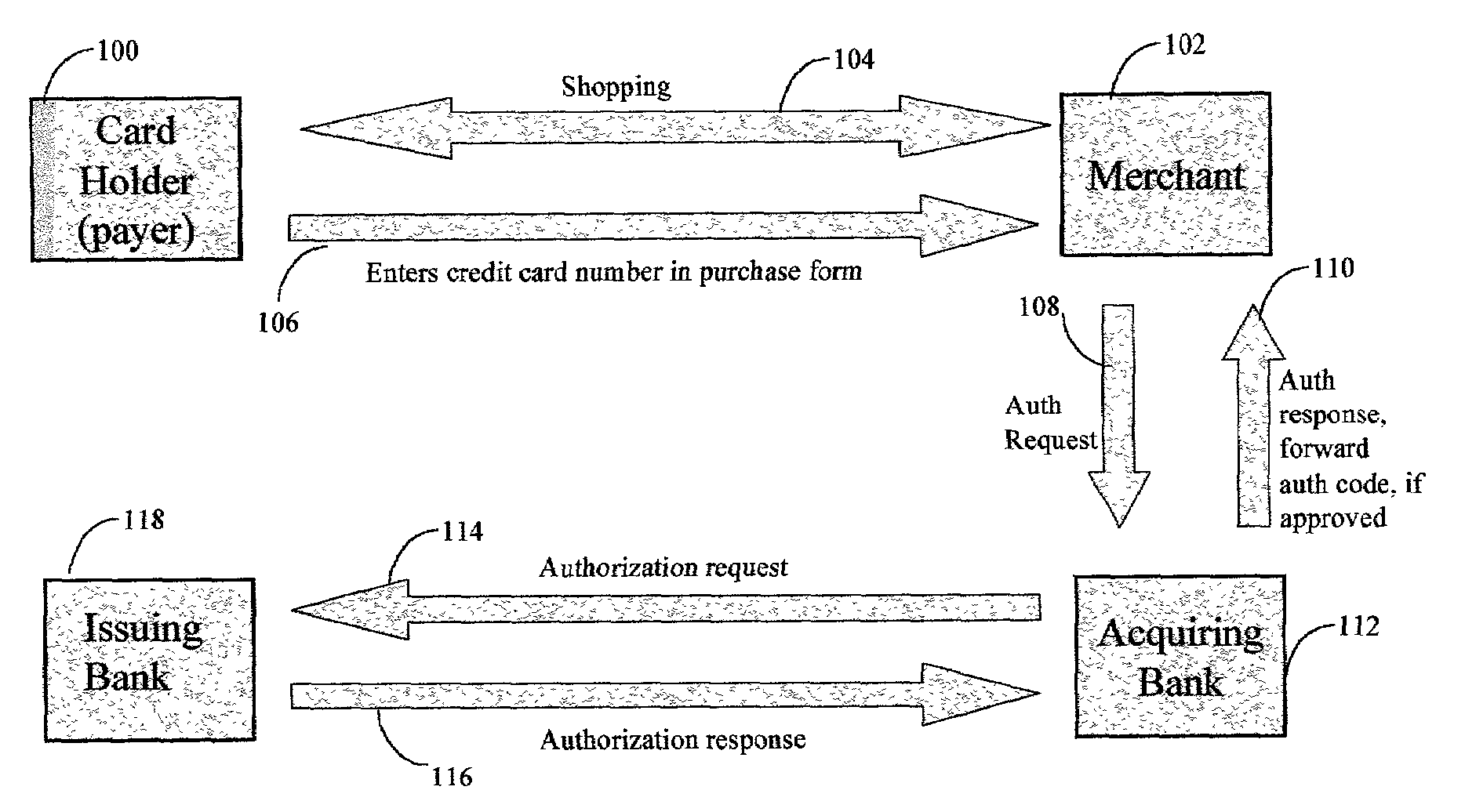

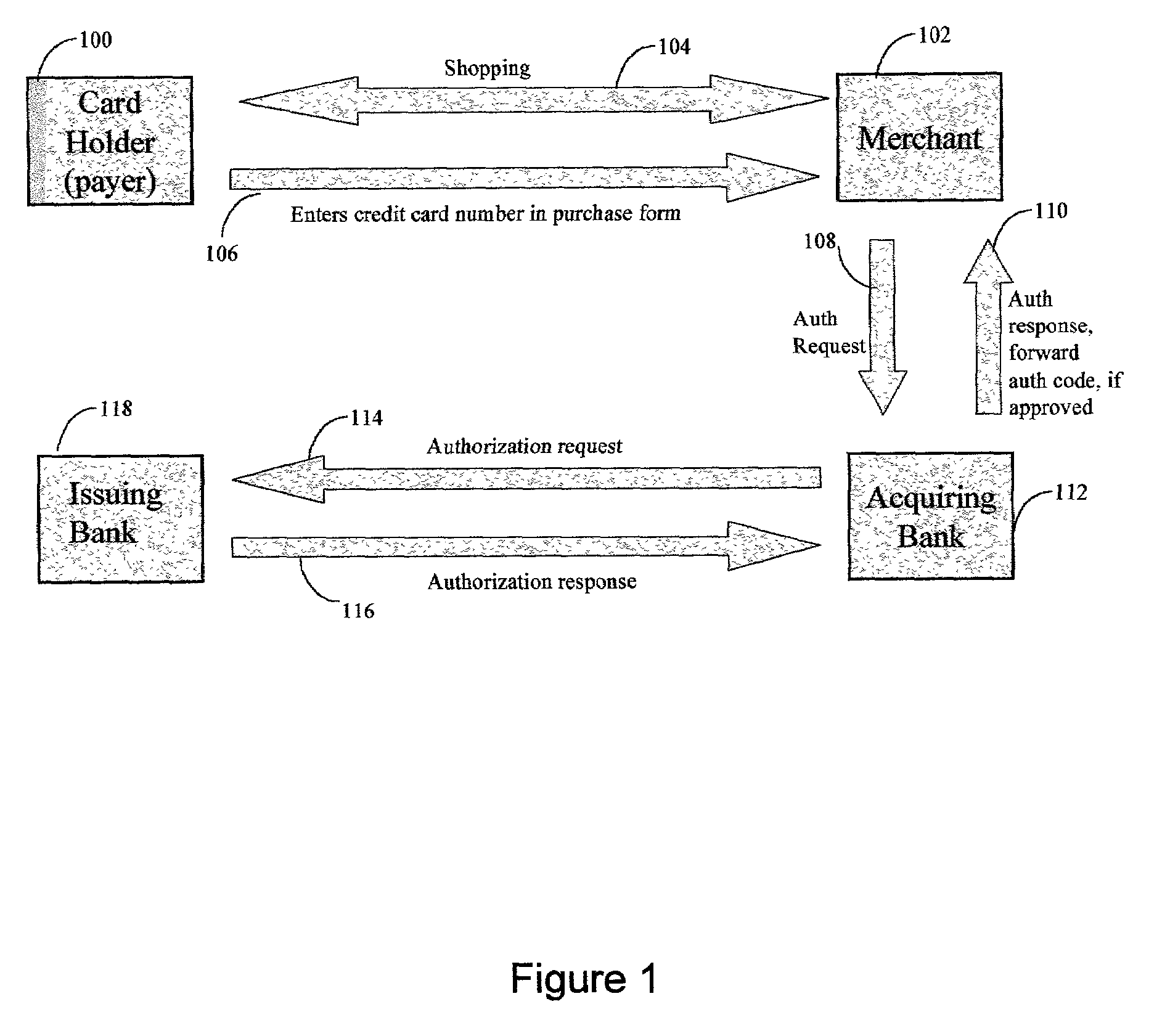

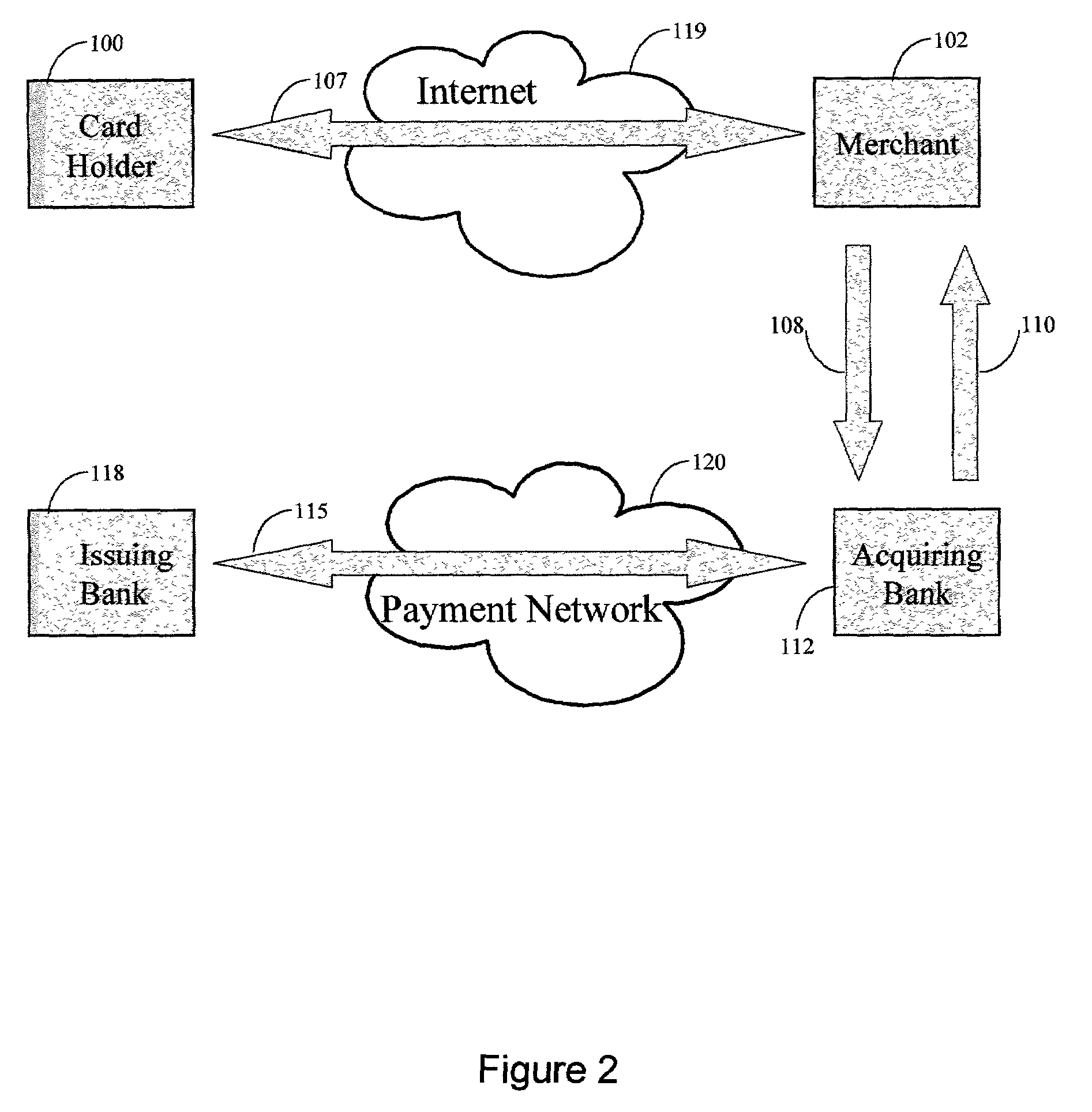

The invention comprises online methods, systems, and software for improving the processing of payments from financial accounts, particularly credit and debit card payments made from consumers to merchants in online transactions. The preferred embodiment of the invention involves inserting a trusted third party online service into the payment authorization process. The trusted third party authenticates the consumer and authorizes the proposed payment in a single integrated process conducted without the involvement of the merchant. The authentication of the consumer is accomplished over a persistent communication channel established with the consumer before a purchase is made. The authentication is done by verifying that the persistent channel is open when authorization is requested. Use of the third party services allows the consumer to avoid revealing his identity and credit card number to the merchant over a public network such as the Internet, while maintaining control of the transaction during the authorization process.

Owner:FISHER DOUGLAS C

Method, transaction card or identification system for transaction network comprising proprietary card network, eft, ach, or atm, and global account for end user automatic or manual presetting or adjustment of multiple account balance payoff, billing cycles, budget control and overdraft or fraud protection for at least one transaction debit using at least two related financial accounts to maximize both end user control and global account issuer fees from end users and merchants, including account, transaction and interchange fees

InactiveUS20070168265A1Increase flexibilityEasy maintenanceComplete banking machinesFinanceCredit cardFinancial transaction

The present invention provides methods, systems and transaction cards or identification systems, using transaction network comprising proprietary card network, EFT, ACH, or ATM, for end user management of a global financial account by manual or automatic prepaying, prepaying, paying or unpaying, debiting or crediting, or readjustment or presetting, using parameters relating to portions of paid or unpaid financial transactions or account balance amounts in multiple credit, cash or other existing, or end user created, financial accounts or sub-accounts in said global financial account that is optionally subject to financial account issuer transaction or readjustment fees from end users and merchants, including optional use for financial transactions as a credit transaction card requiring merchant credit card interchange or other fees, and optional end user fees, as additional revenue to the global account issuer.

Owner:ROSENBERGER RONALD JOHN

Magnetic data recording device

Owner:FITBIT INC

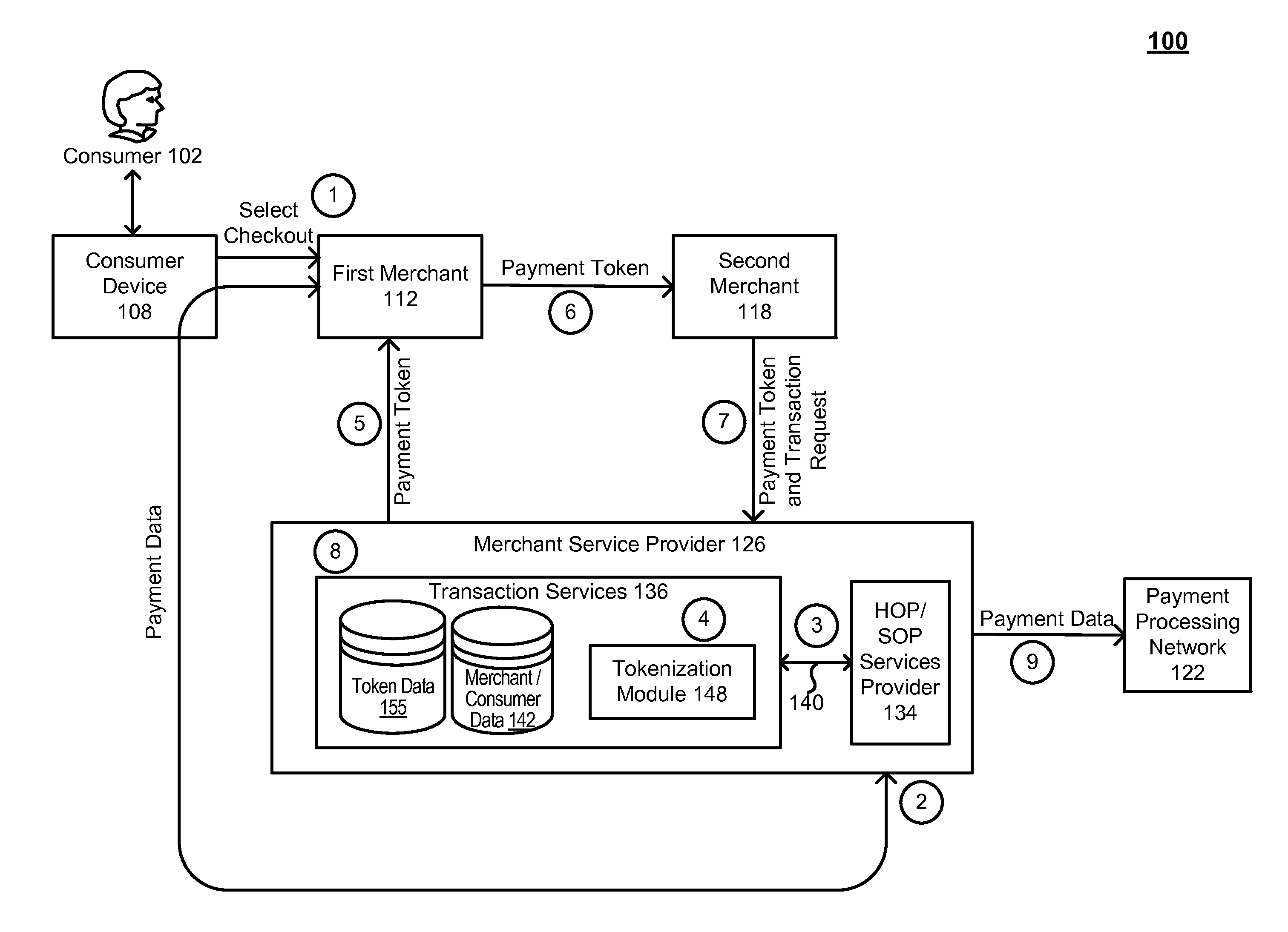

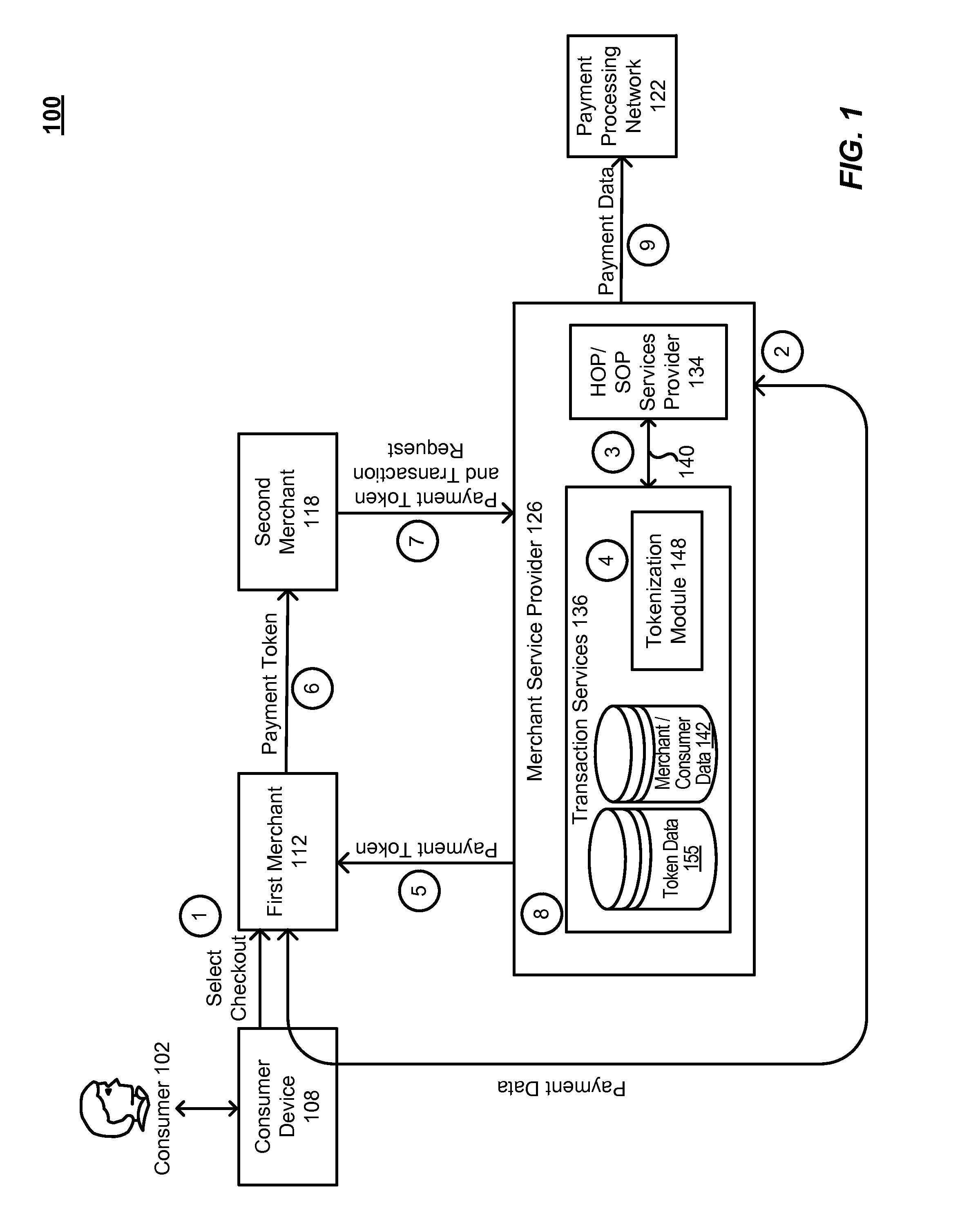

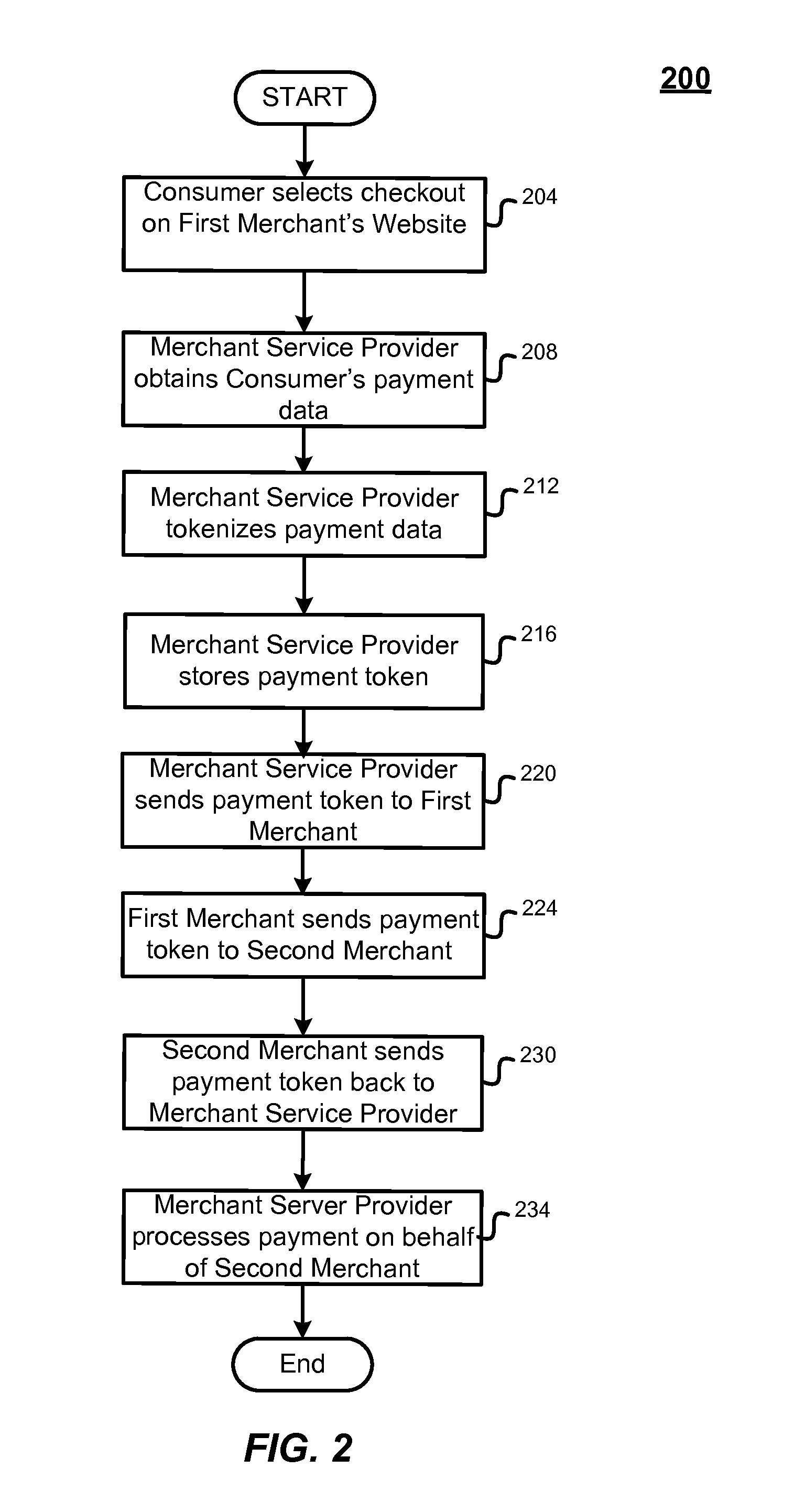

System and method of providing tokenization as a service

ActiveUS20130198080A1Reduce the possibilityReduce riskFinanceDebit schemesService systemService provision

Systems, devices, apparatuses, and methods for providing tokenization as a service are provided. Embodiments of the invention involve decoupling a “tokenization service” from other services offered by a merchant service provider, and offering the tokenization service as a stand-alone service. In accordance with an embodiment, a merchant service provider can receive payment data associated with a transaction between a consumer and a first entity. The merchant service provider can generate a payment token that represents the payment data and transmit a copy of the payment token to the first entity. The first entity can then transmit the payment token and order information to a second entity specified in the transaction. The merchant service provider can subsequently receive a request to complete the transaction from the second entity. The request can include the copy of the payment token from the second entity.

Owner:VISA INT SERVICE ASSOC

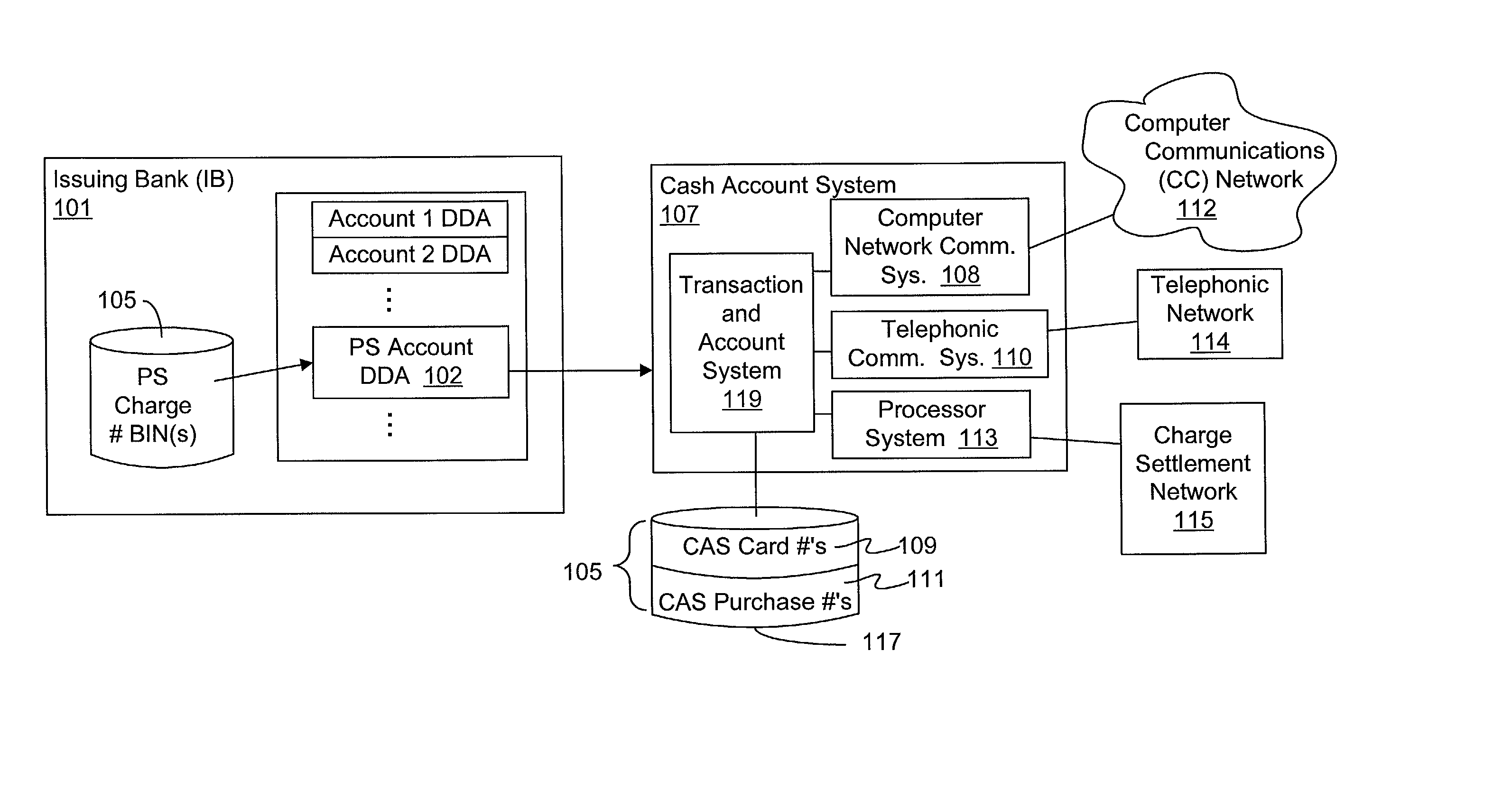

Online content portal system

InactiveUS20020095387A1Reduce decreaseCredit registering devices actuationFinanceThird partyCredit card

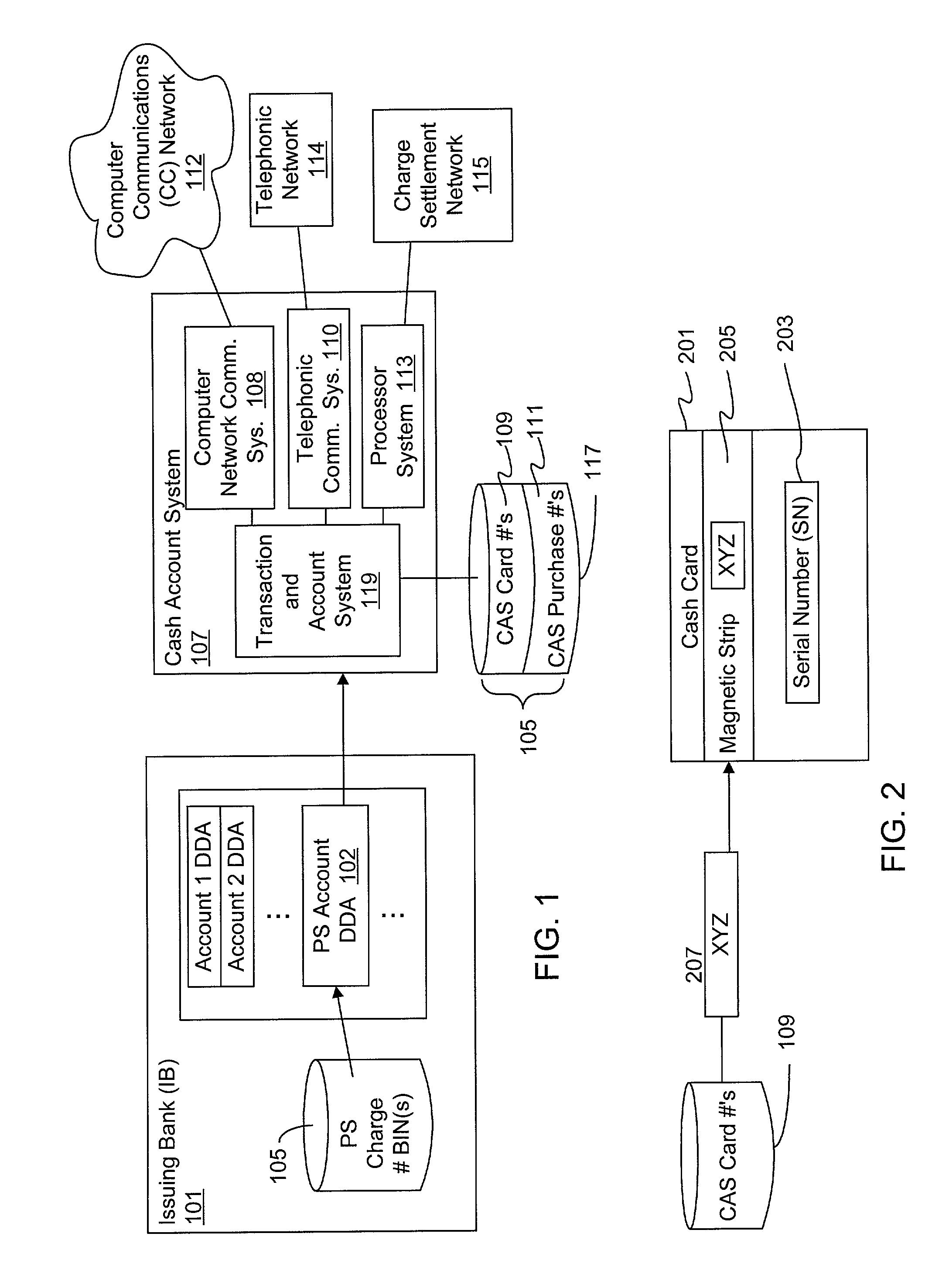

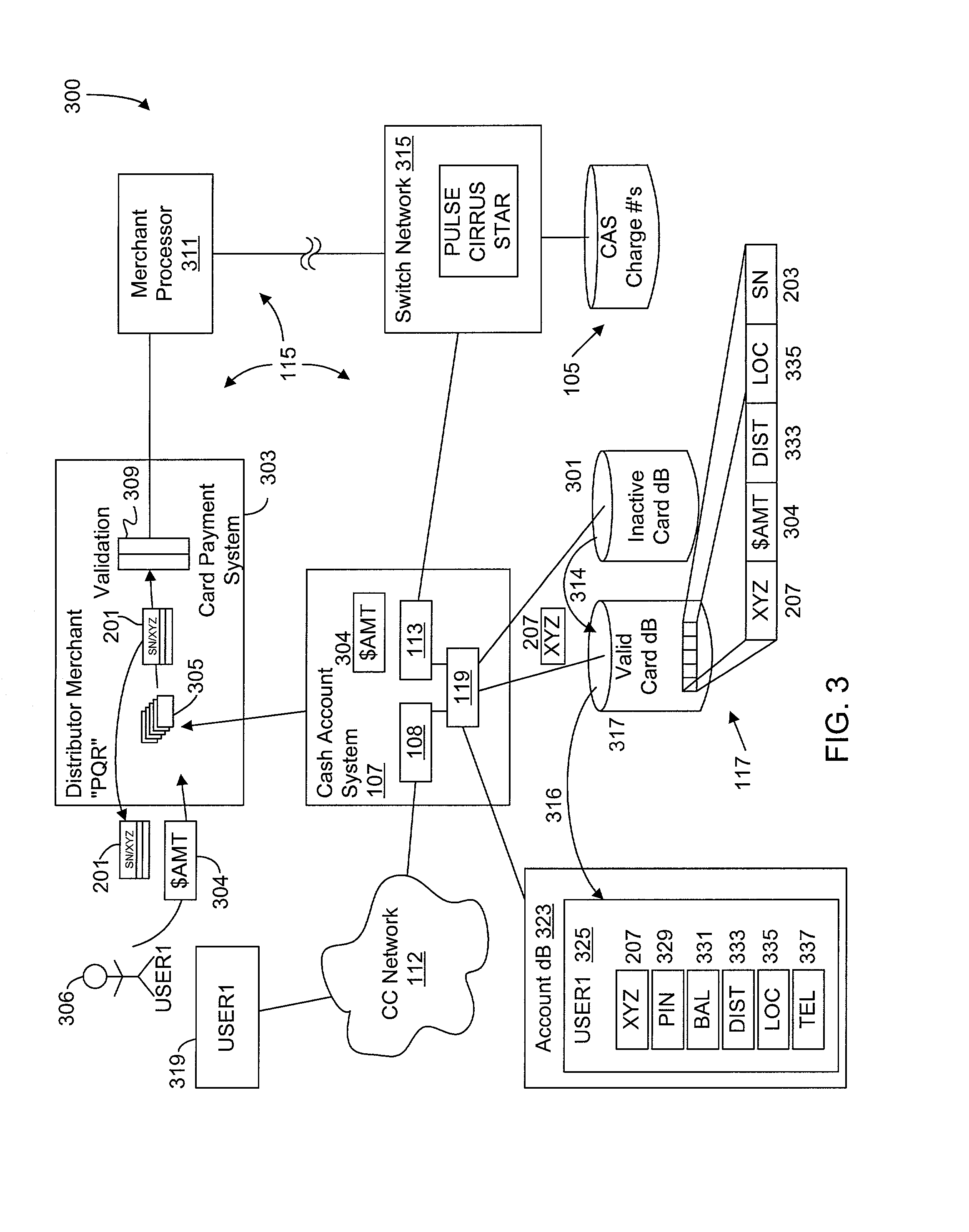

A system and method of providing an online content portal for sending affiliate content to users of an online account system via the Internet. An online content portal is provided with each user cash account for sending affiliate content. Users conduct purchase transactions with third parties via the Internet using online cash account funds. The system is configured to provide valid charge numbers acceptable to the third parties to consummate the purchase transactions. The charge numbers are similar to standard credit card numbers and universally accepted, where the system is also configured to be the processor of such charge numbers. The shopping and purchase activity of users is monitored and stored along with account information in a user information database. Affiliates may download and / or search the user information database to target users for sending the affiliate content. The online content portal system facilitates collection of valuable user information and identification of users to receive selected types of content.

Owner:NETABPEND CORP

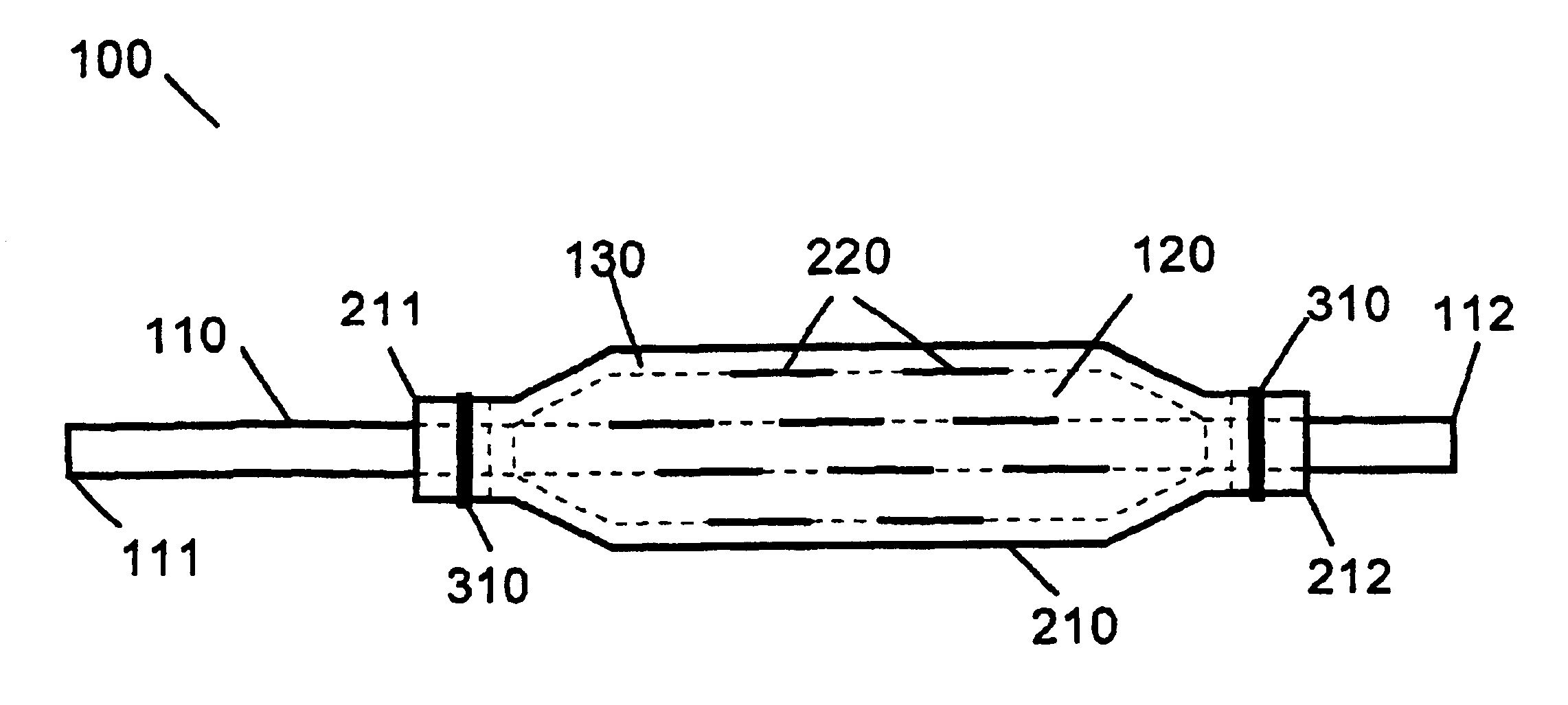

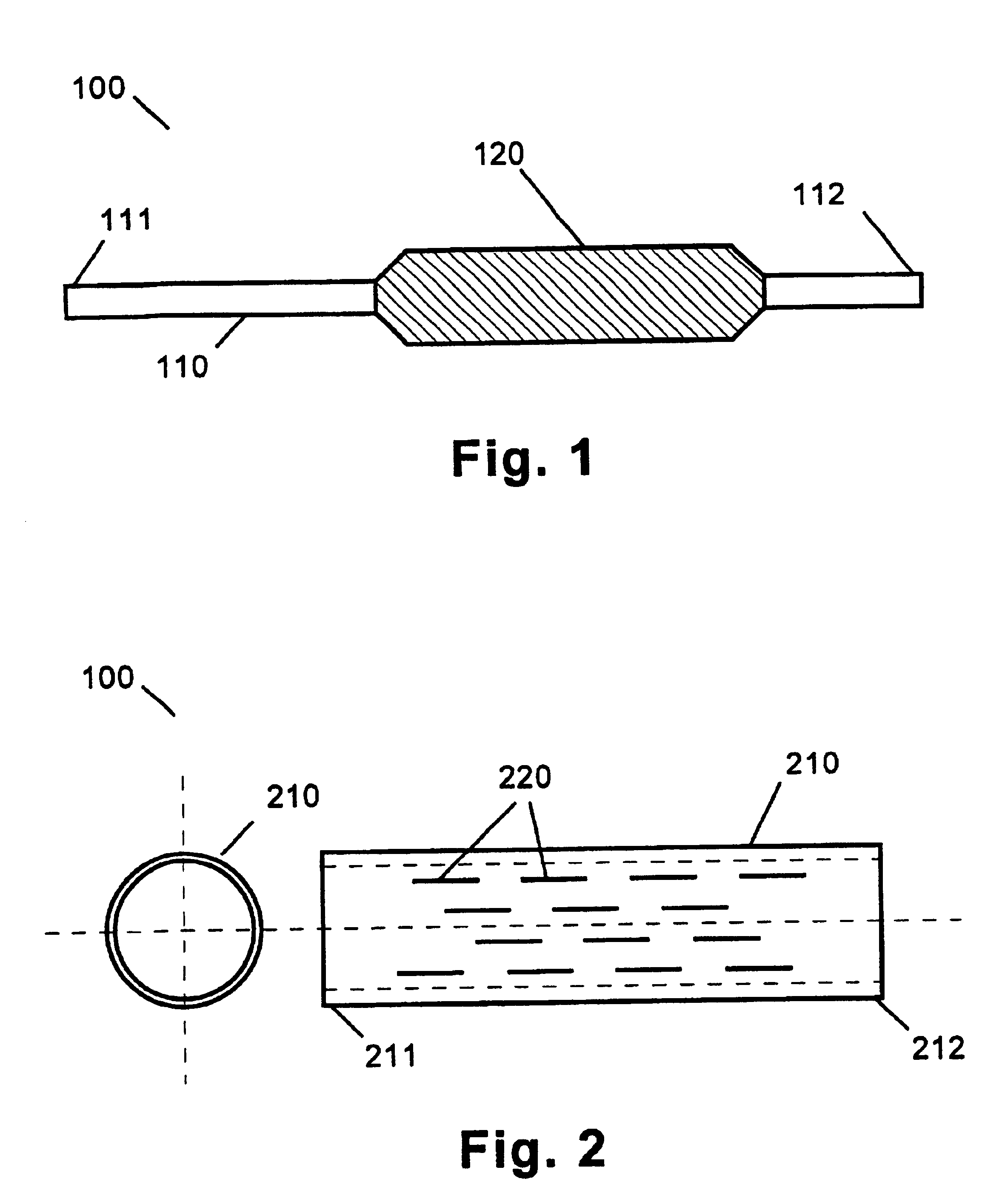

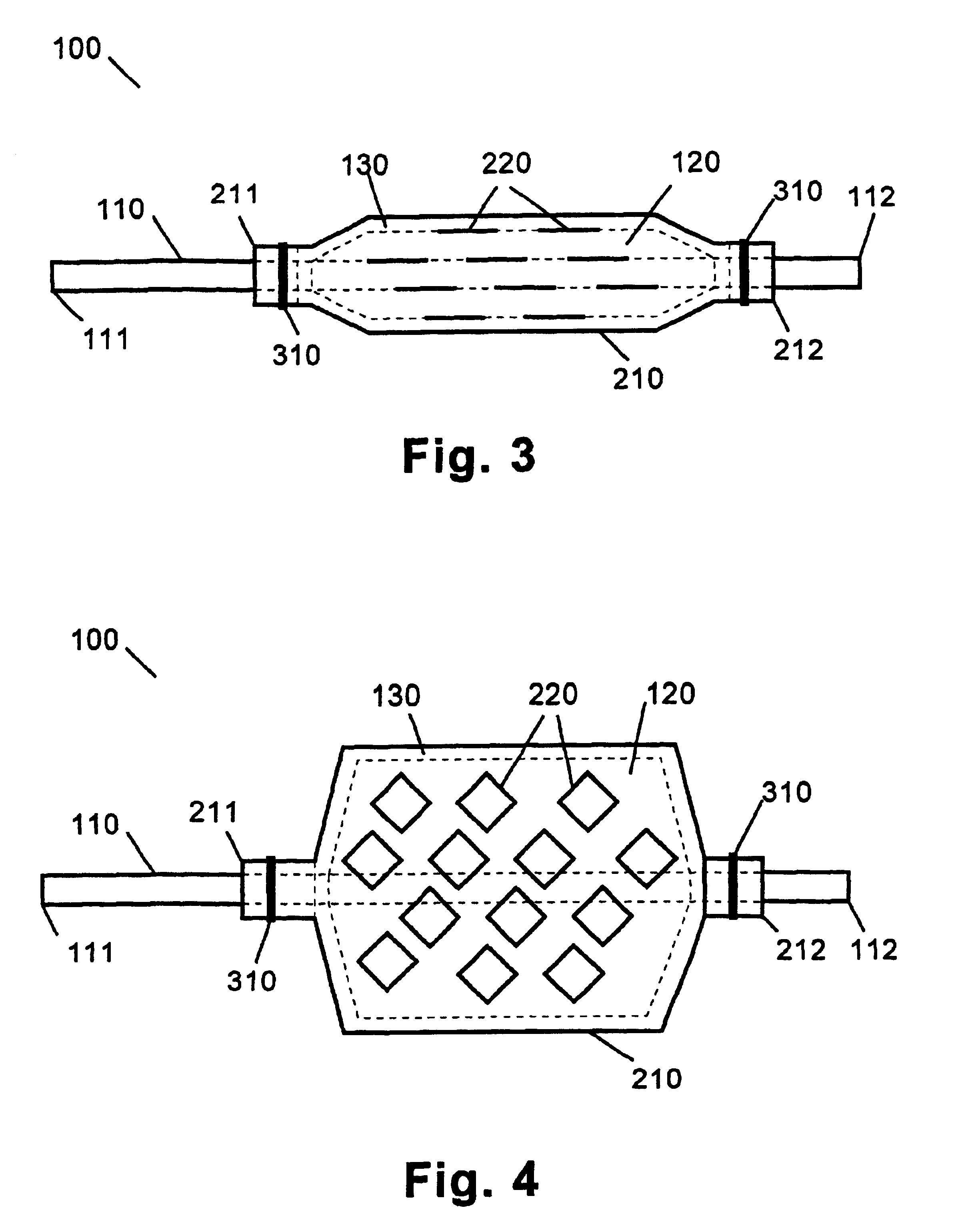

Localized delivery of drug agents

Medical devices including a substrate that are expandable from a compressed state to an expanded state; a coating on the substrate, the coating having a drug agent incorporated therein; and a sheath over the coating. The sheath is expandable from a compressed state to an expanded state and has at least one perforation therein. The medical devices are configured such that when the substrate is in a compressed state, the sheath is also in a compressed state and the perforation is substantially closed. When the substrate is in an expanded state, the sheath is also in an expanded state and the perforation is substantially open. The invention also includes a method of using the medical devices for the controlled, localized delivery of a drug agent to a target location within a mammalian body.

Owner:BOSTON SCI SCIMED INC

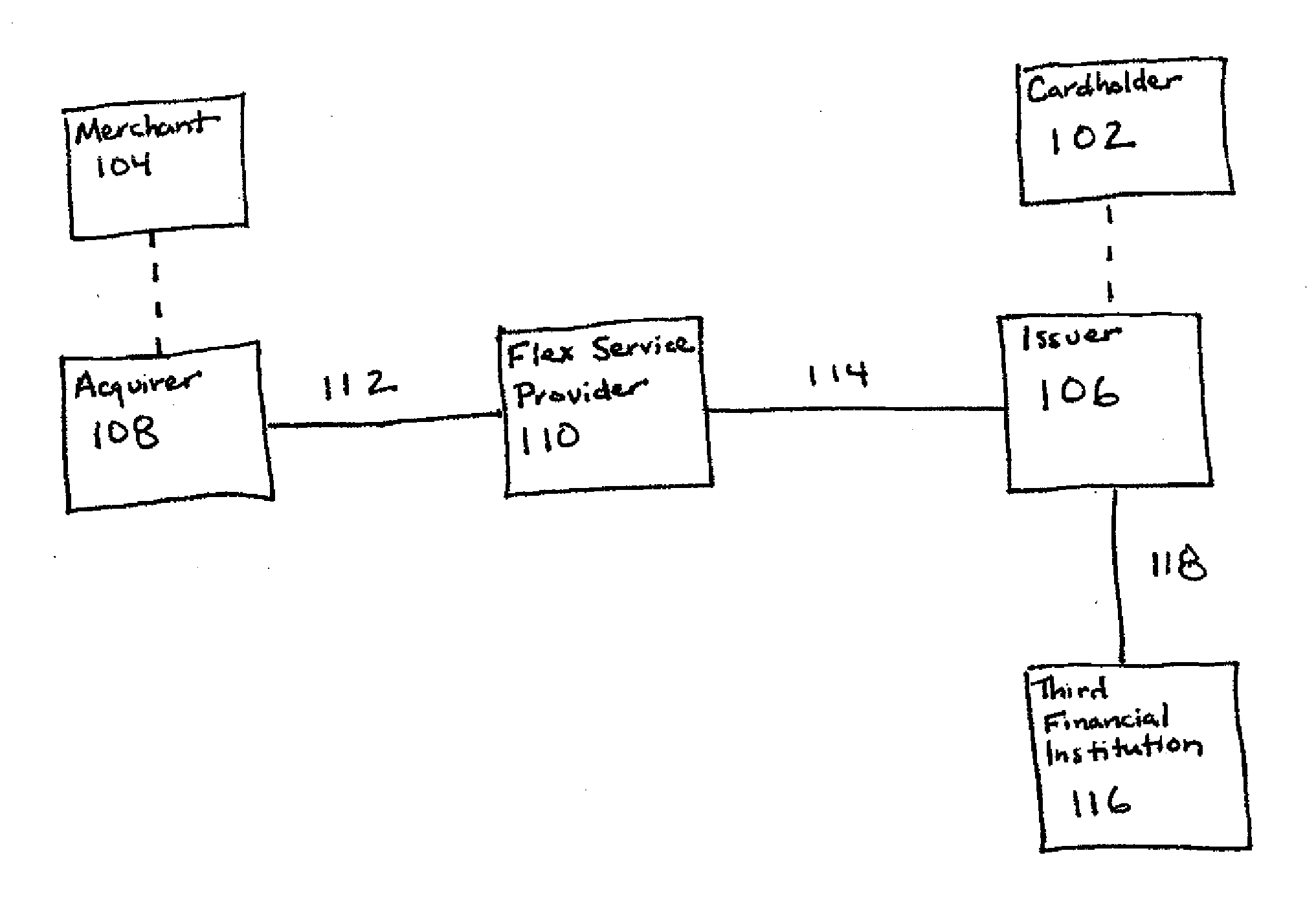

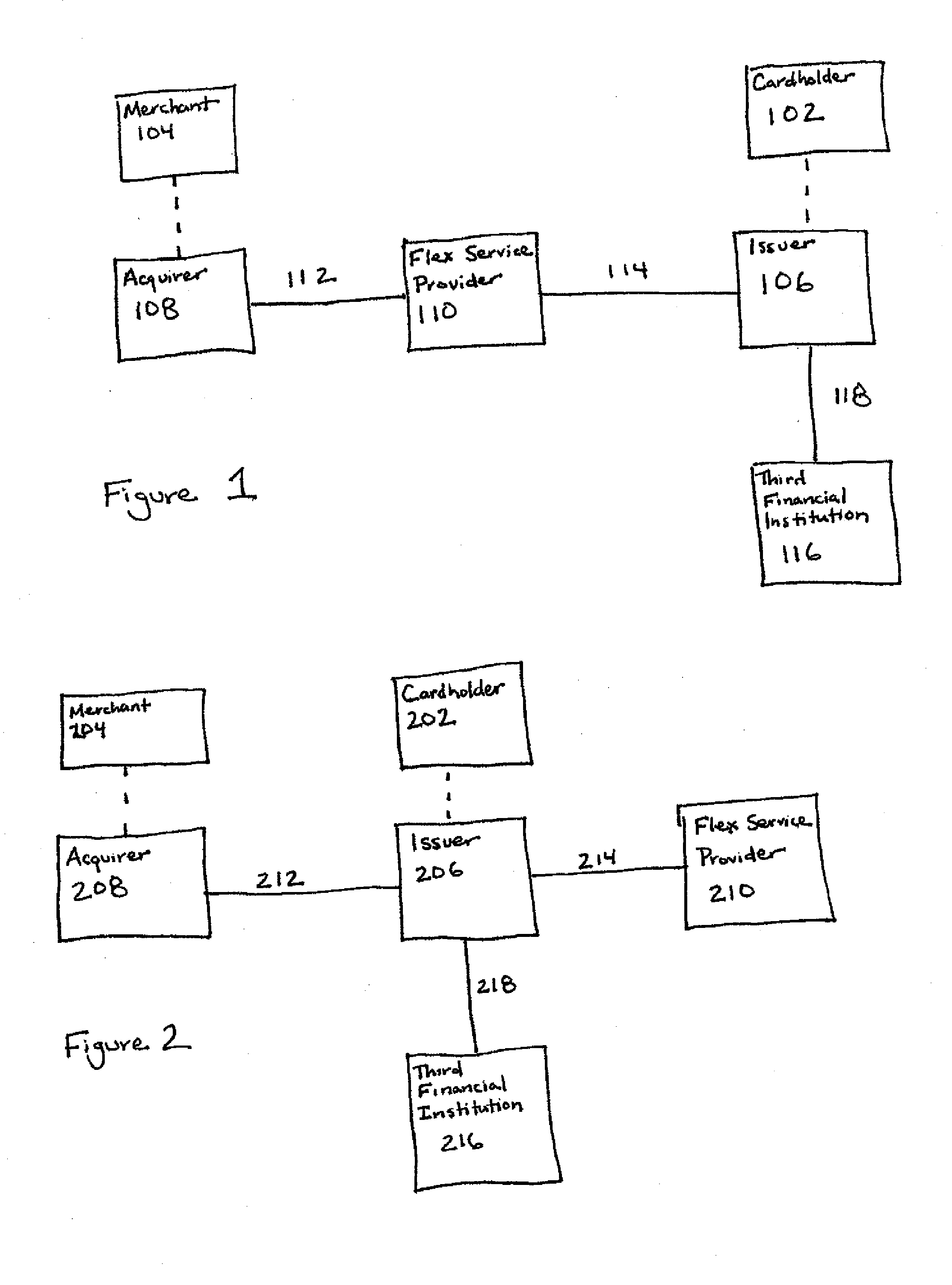

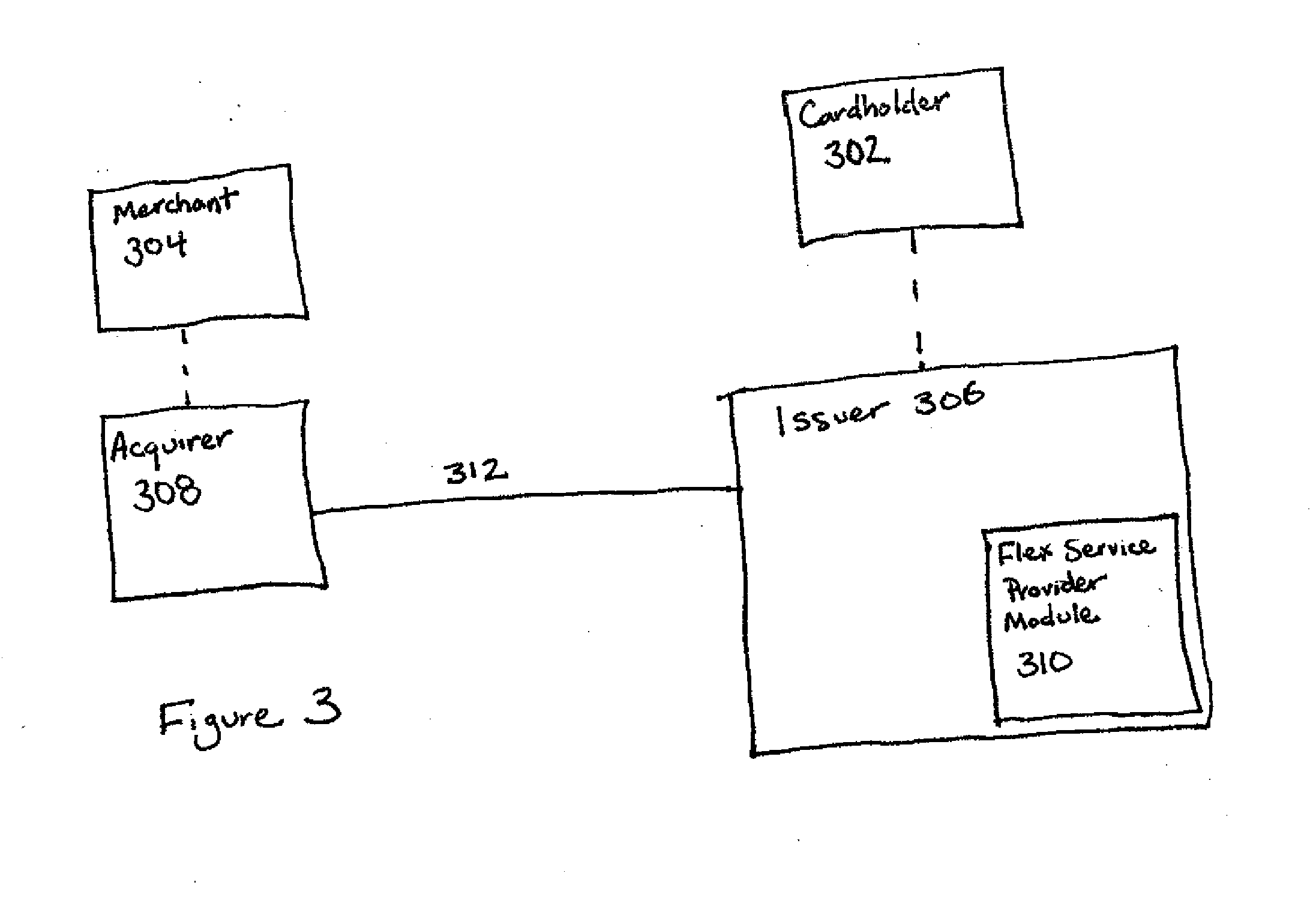

Systems and methods for appending supplemental payment data to a transaction message

A managing platform for appending supplemental payment data to a transaction message receives a transaction message representative of a credit card transaction from a merchant or an associated financial institution. The managing platform uses the transaction data contained in the transaction message and other information to determine whether the transaction satisfies one or more payment rules previously established by the cardholder. If the transaction satisfies a payment rule, the managing platform appends supplemental payment data to the transaction message in a format specified by a financial institution associated with the cardholder. The supplemental payment data includes information identifying a secondary payment account associated with the satisfied payment rule. The managing platform subsequently transmits the appended transaction message to the financial institution associated with the cardholder.

Owner:MASTERCARD INT INC

Persistent Dynamic Payment Service

The invention comprises online methods, systems, and software for improving the processing of payments from financial accounts, particularly credit and debit card payments made from consumers to merchants in online transactions. The preferred embodiment of the invention involves inserting a trusted third party online service into the payment authorization process. The trusted third party authenticates the consumer and authorizes the proposed payment in a single integrated process conducted without the involvement of the merchant. The authentication of the consumer is accomplished over a persistent communication channel established with the consumer before a purchase is made. The authentication is done by verifying that the persistent channel is open when authorization is requested. Use of the third party services allows the consumer to avoid revealing his identity and credit card number to the merchant over a public network such as the Internet, while maintaining control of the transaction during the authorization process.

Owner:FISHER DOUGLAS C +1

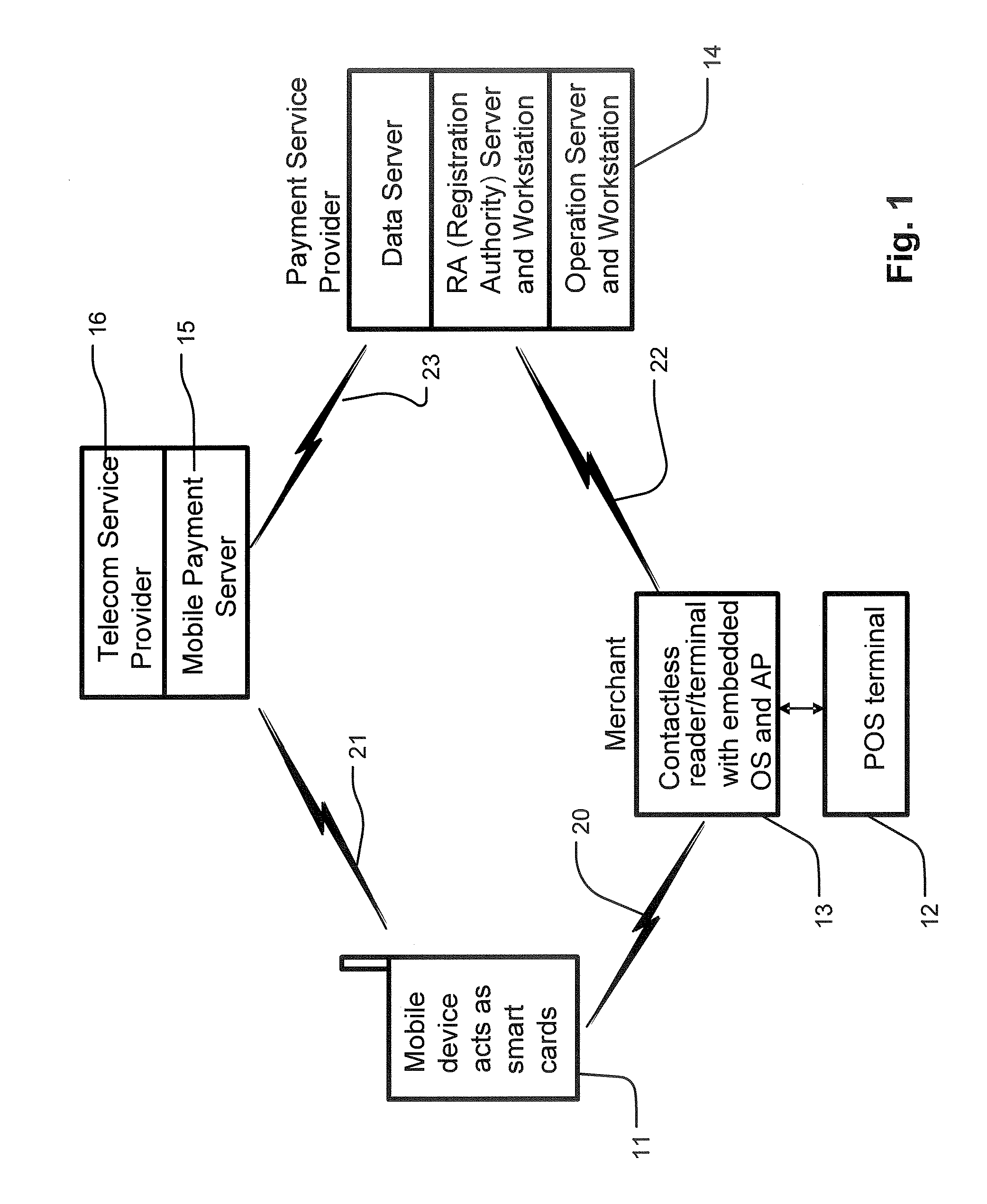

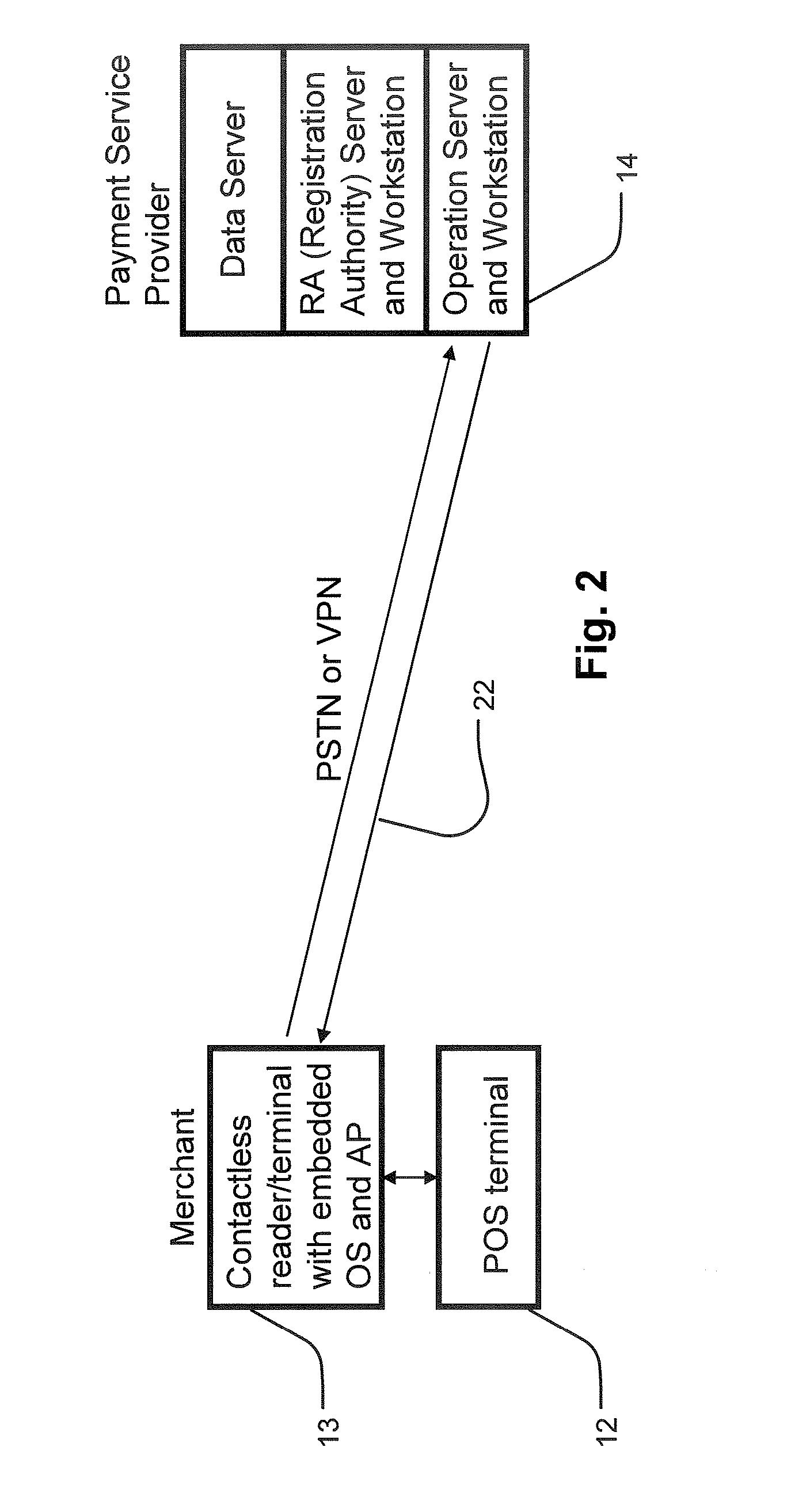

System and Method of Managing Contactless Payment Transactions Using a Mobile Communication Device As A Stored Value Device

ActiveUS20080167988A1Improve securityUnauthorised/fraudulent call preventionDigital data processing detailsPayment transactionComputer science

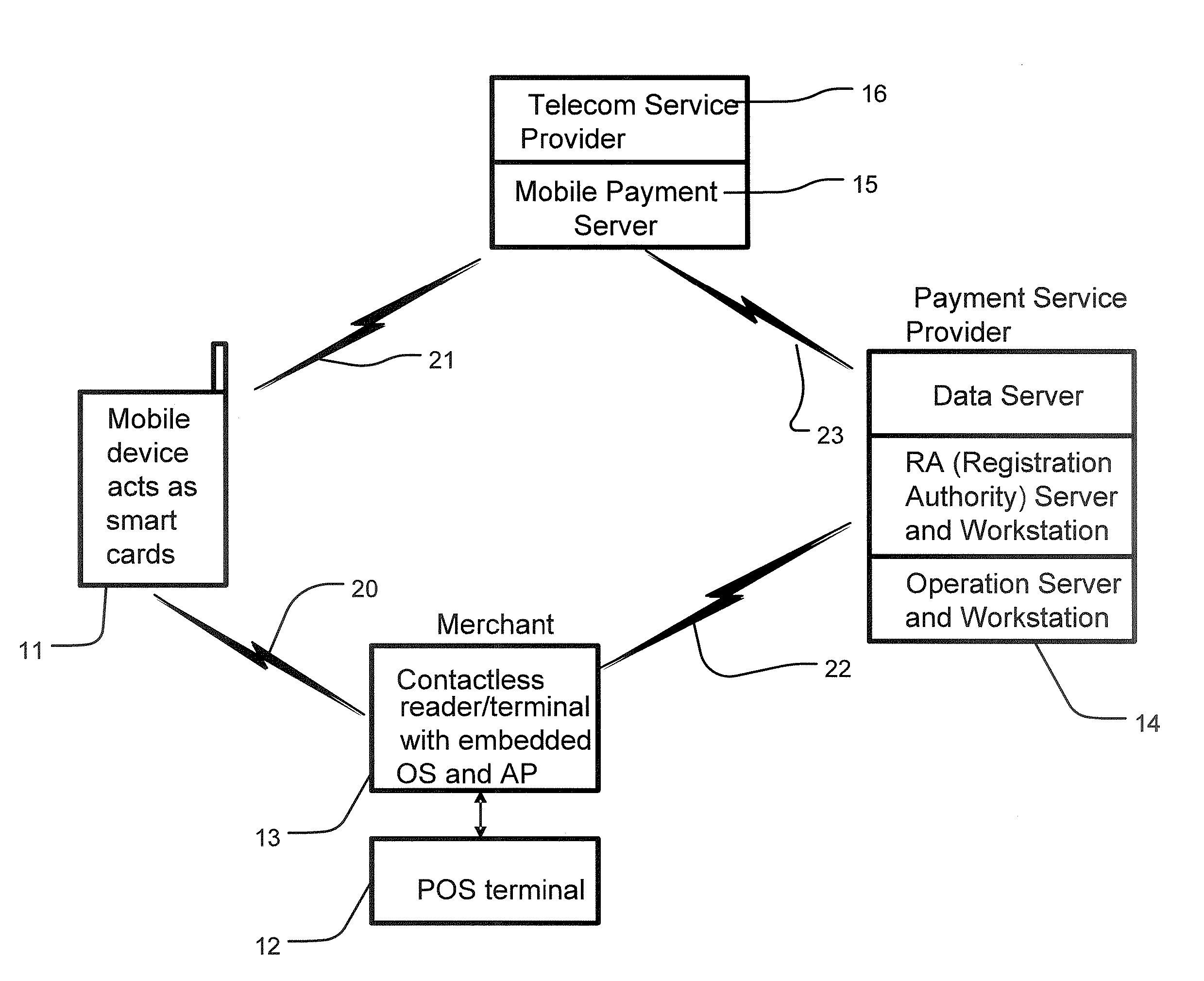

A method and apparatus handling payment transactions in a system using mobile communication devices as stored value devices are disclosed. A transaction operations server receives multiple records of the transaction from the stored value device—one via a communication channel through the telecommunication provider network, and another via an independent communication channel. The records are reconciled at the transaction server for transaction verification.

Owner:MACRONIX INT CO LTD

Multiple account preset parameter method, apparatus and systems for financial transactions and accounts

InactiveUS20060259390A1Increased riskEasy to chargeFinanceDebit schemesFinancial transactionSmart card

Methods, apparatus and systems are provided that enables at least one debit for a financial transaction and account management features using at least two financial accounts from which such debits and / or credits can be made from said at least two financial accounts using preset financial account parameters including, but not limited to, at least one ratio, an amount threshold, a remainder threshold, a minimum available account balance, a maximum available account balance, a minimum debit amount, a range of debit amounts, a maximum debit amount, a qualitative or quantitative aspect of at least one said financial accounts, or any combination thereof, and / or other parameters, such as, but not limited to at least one threshold amount and / or remainder amount. The transaction processor also allows account debiting or account crediting parameters to be set in accordance to any merchant identifier information, and permits account balances used for a given transaction to be readjusted after said transaction has been posted. A smart card or personal identification systems embodiment of the transaction processor comprising certain capabilities of the global financial card account embodiment is also provided.

Owner:ROSENBERGER RONALD J

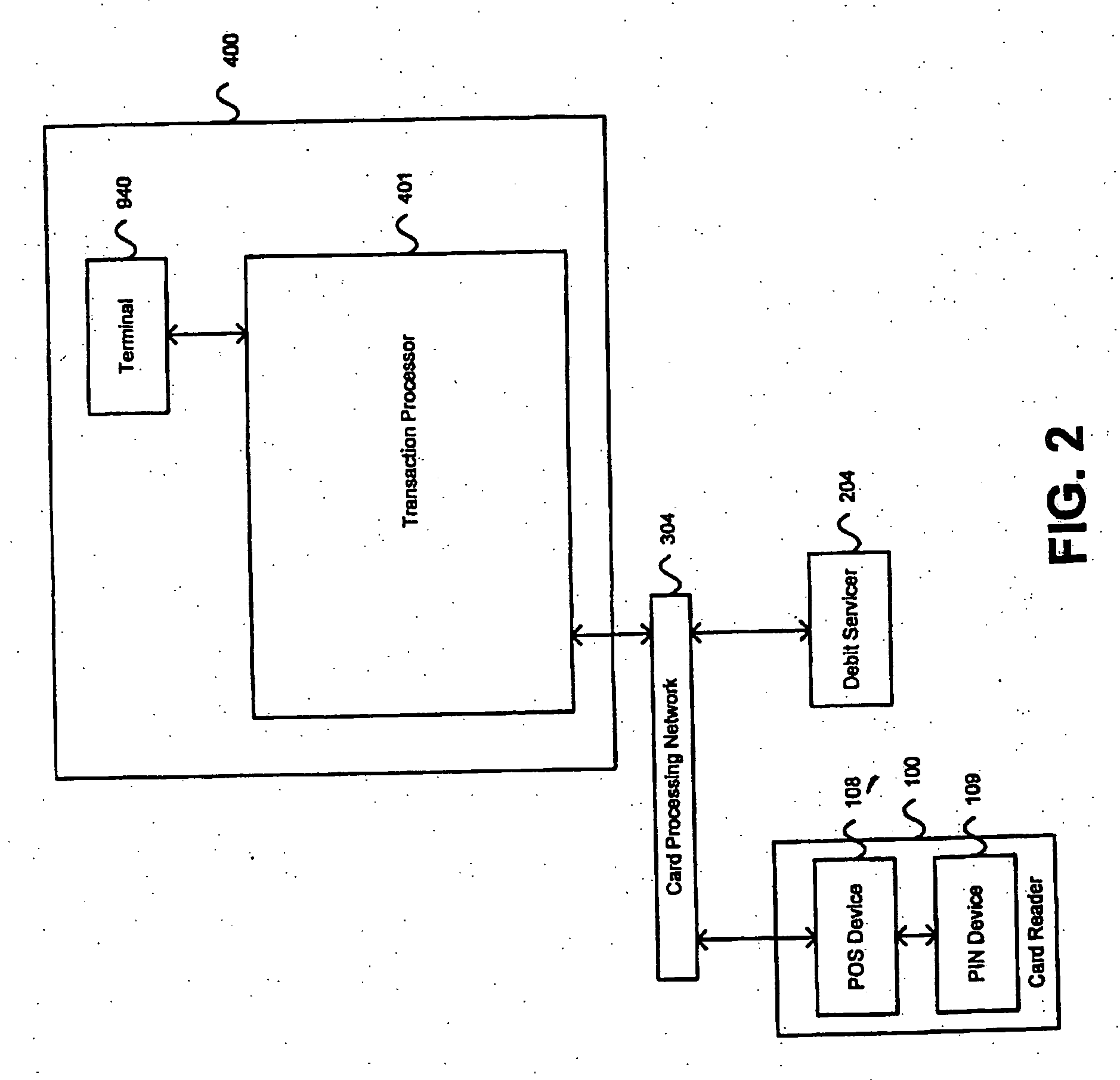

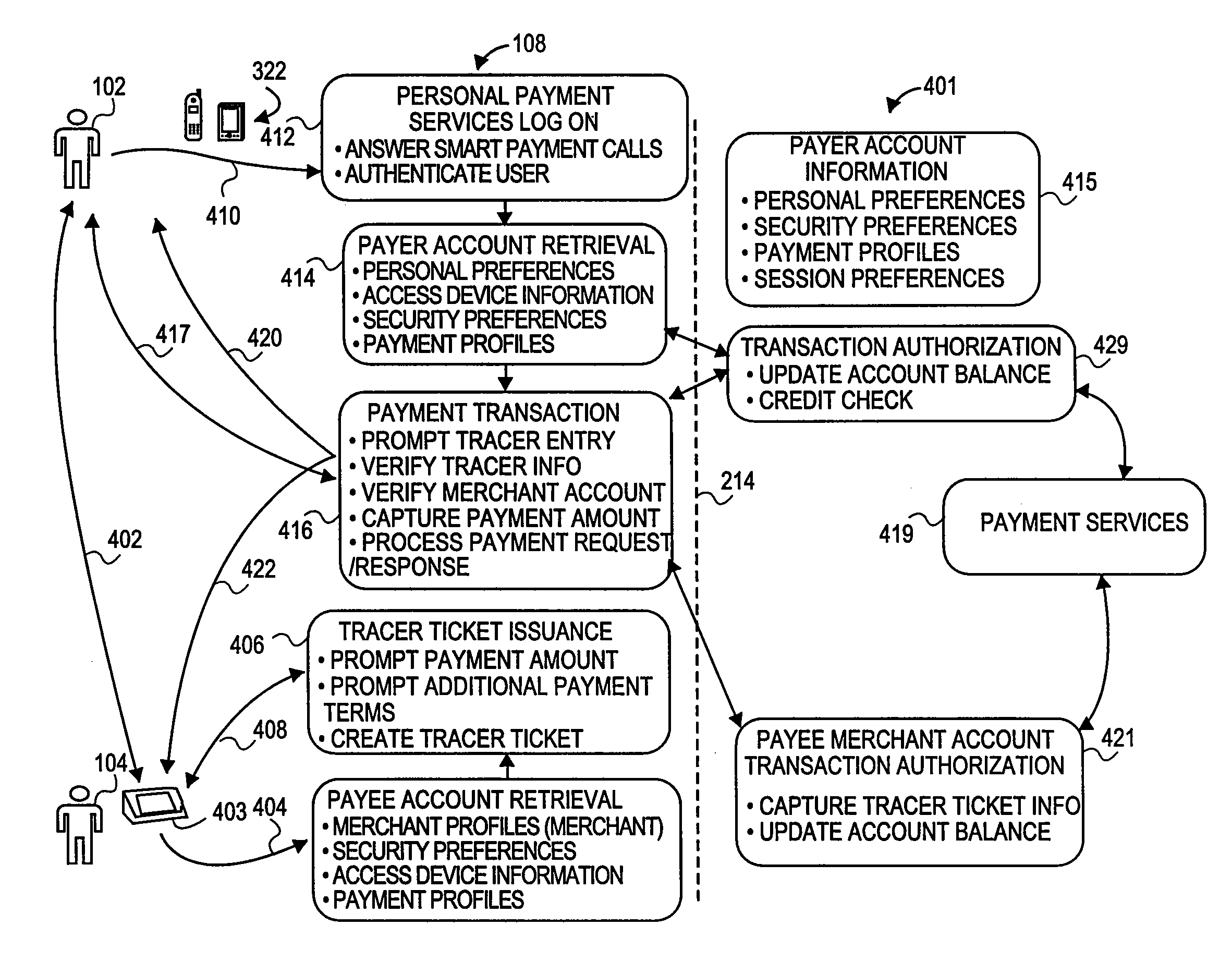

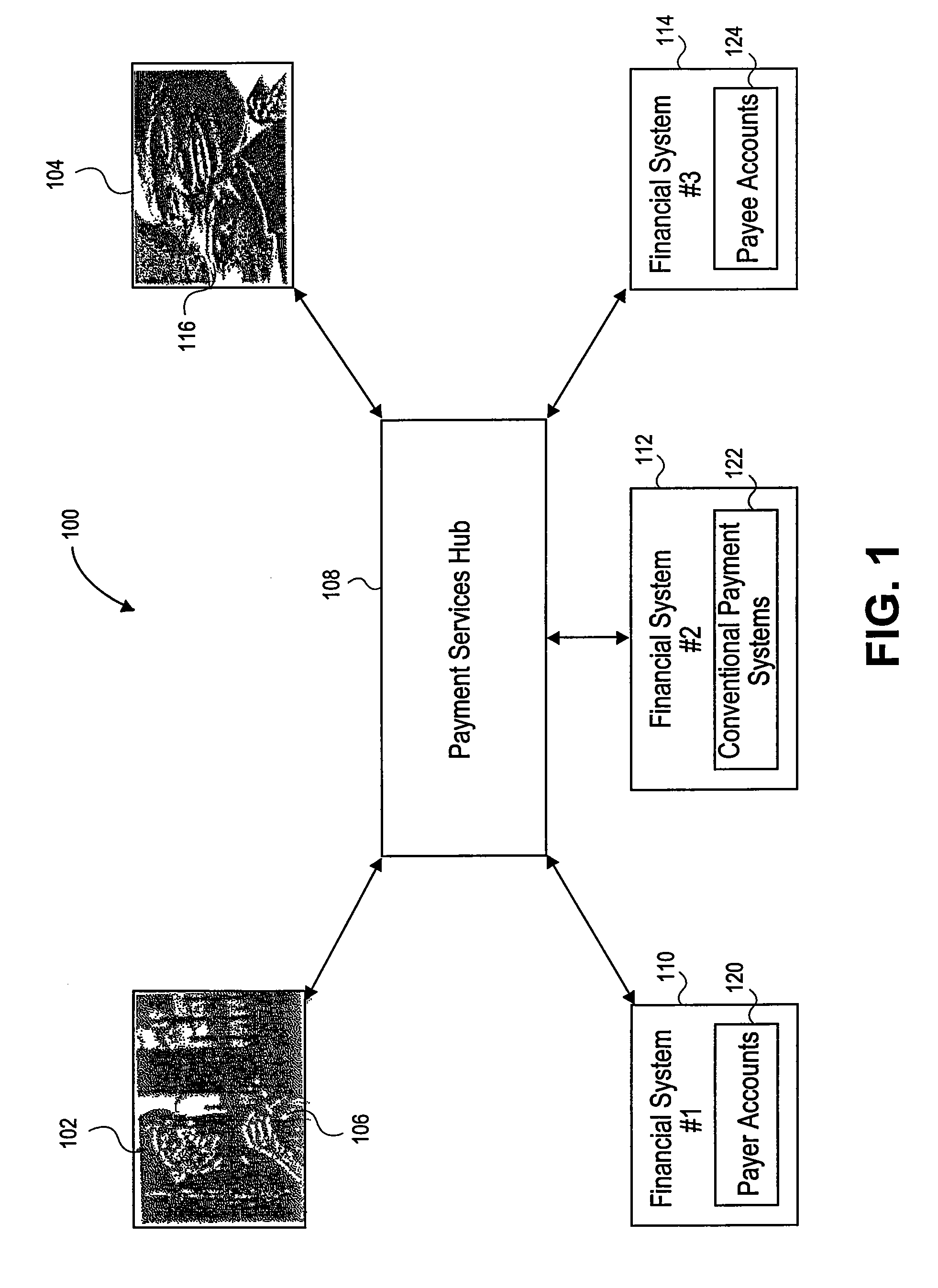

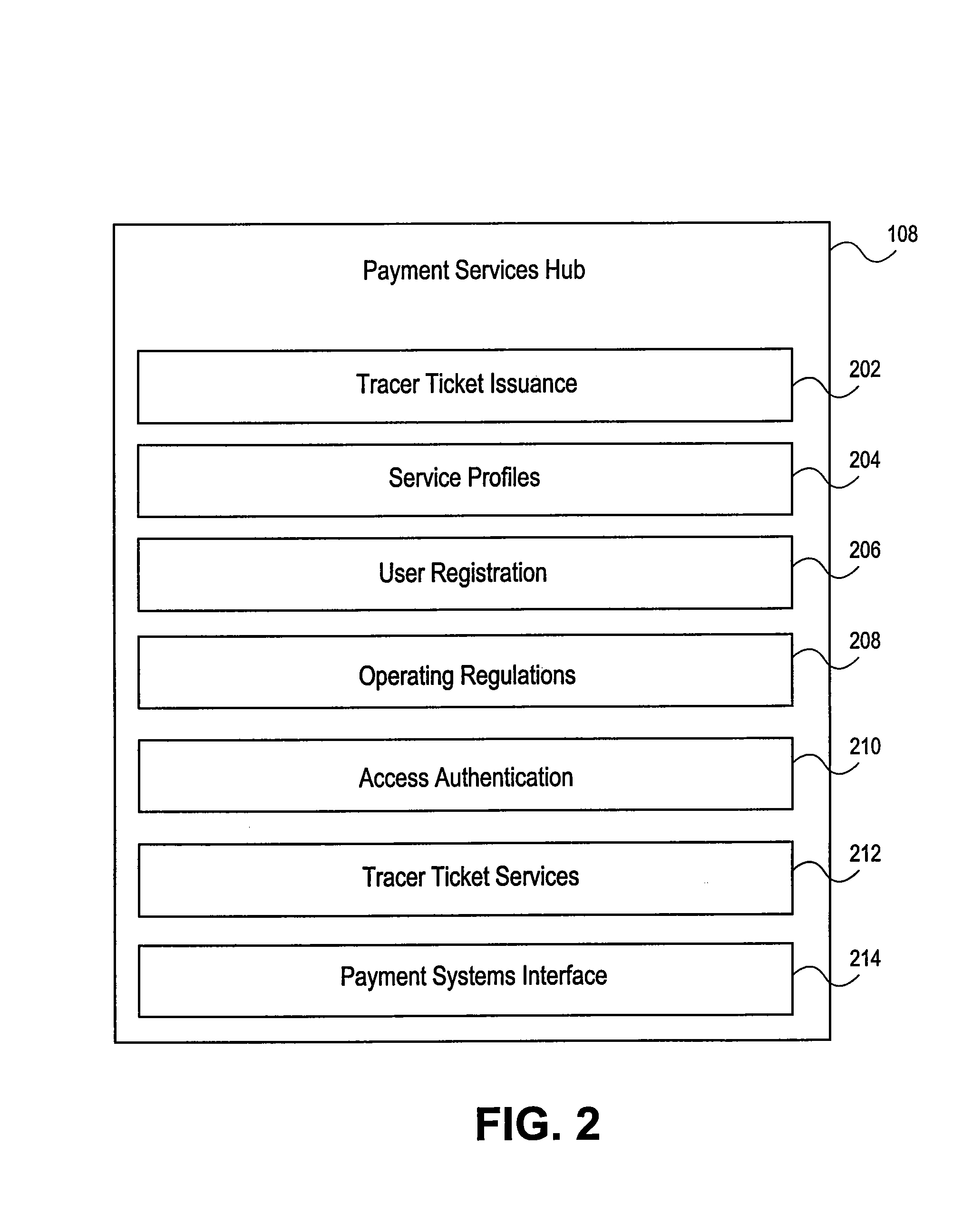

Method and system for facilitating payment transactions using access devices

A payment system for facilitating a payment transaction between a payer and a payee is disclosed. The payment system includes a payer access device, a payee access device, and a services hub. The services hub is configured to communicate with the payer device and the payee device; maintain information relating to a payer account and access device information associated with the payer account, the payer account being linked to the access device; generate a tracer ticket in response to a request issued by the payer using either the payer device or the payee device, the tracer ticket containing information relating to the payment transaction; validate the access devices; and authorize the payment transaction against the payer account through conventional payment processing systems. Upon receiving the request from the payee device for the tracer ticket, the services hub generates the tracer ticket and forwards a copy thereof to the payer via the payee device. Upon receiving the copy of the tracer ticket, the payer uses the payer device to communicate with the services hub and forward the received copy of the tracer ticket to the services hub. The services hub then validates the payer device based on the access device information. Upon validation of the payer device, the services hub checks the copy of the tracer ticket forwarded by the access device against the previously generated tracer ticket. If the copy of the tracer ticket forwarded by the access device corresponds to the previously generated tracer ticket, the services hub authorizes the payment transaction against the payer account.

Owner:VISA USA INC (US)

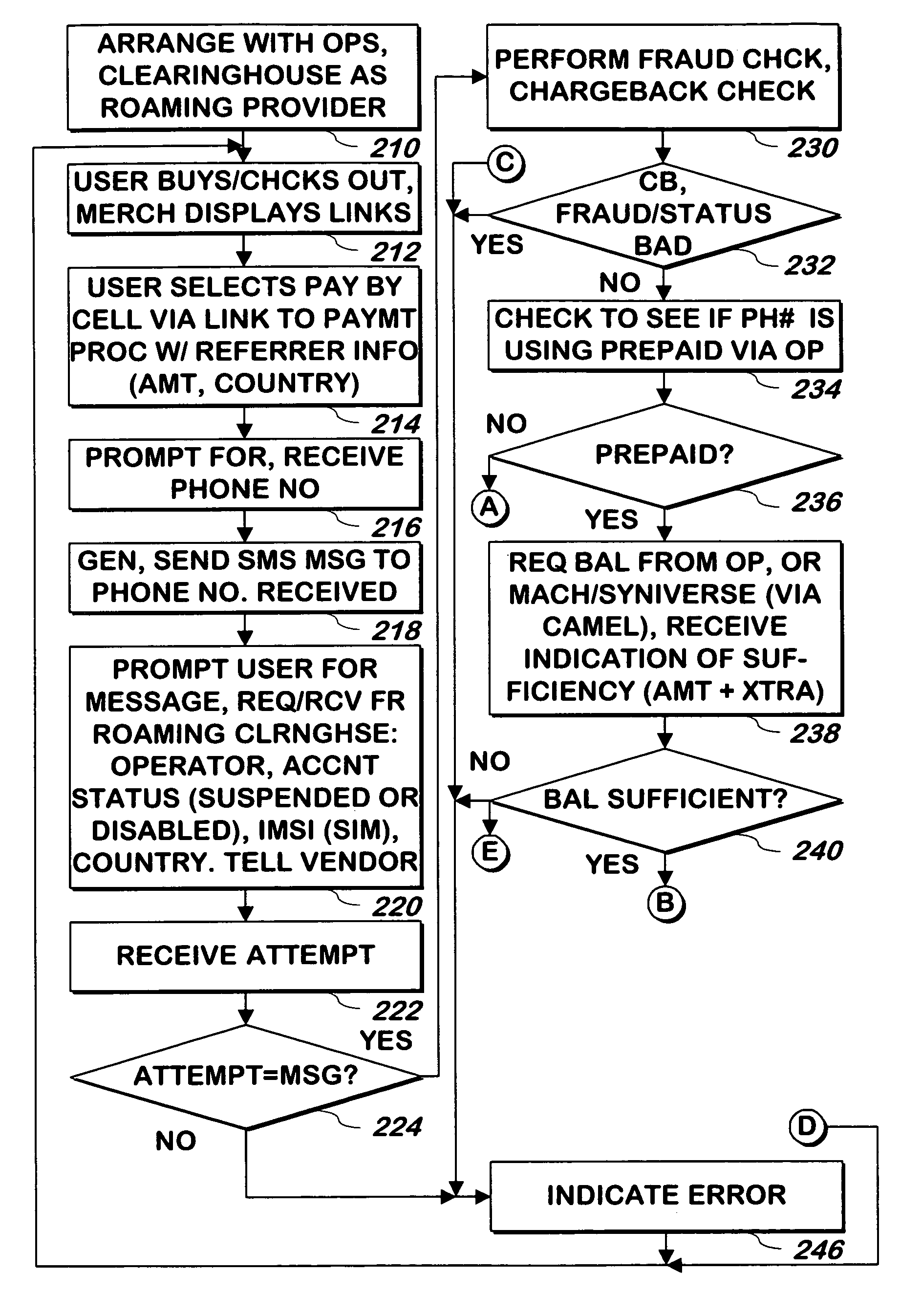

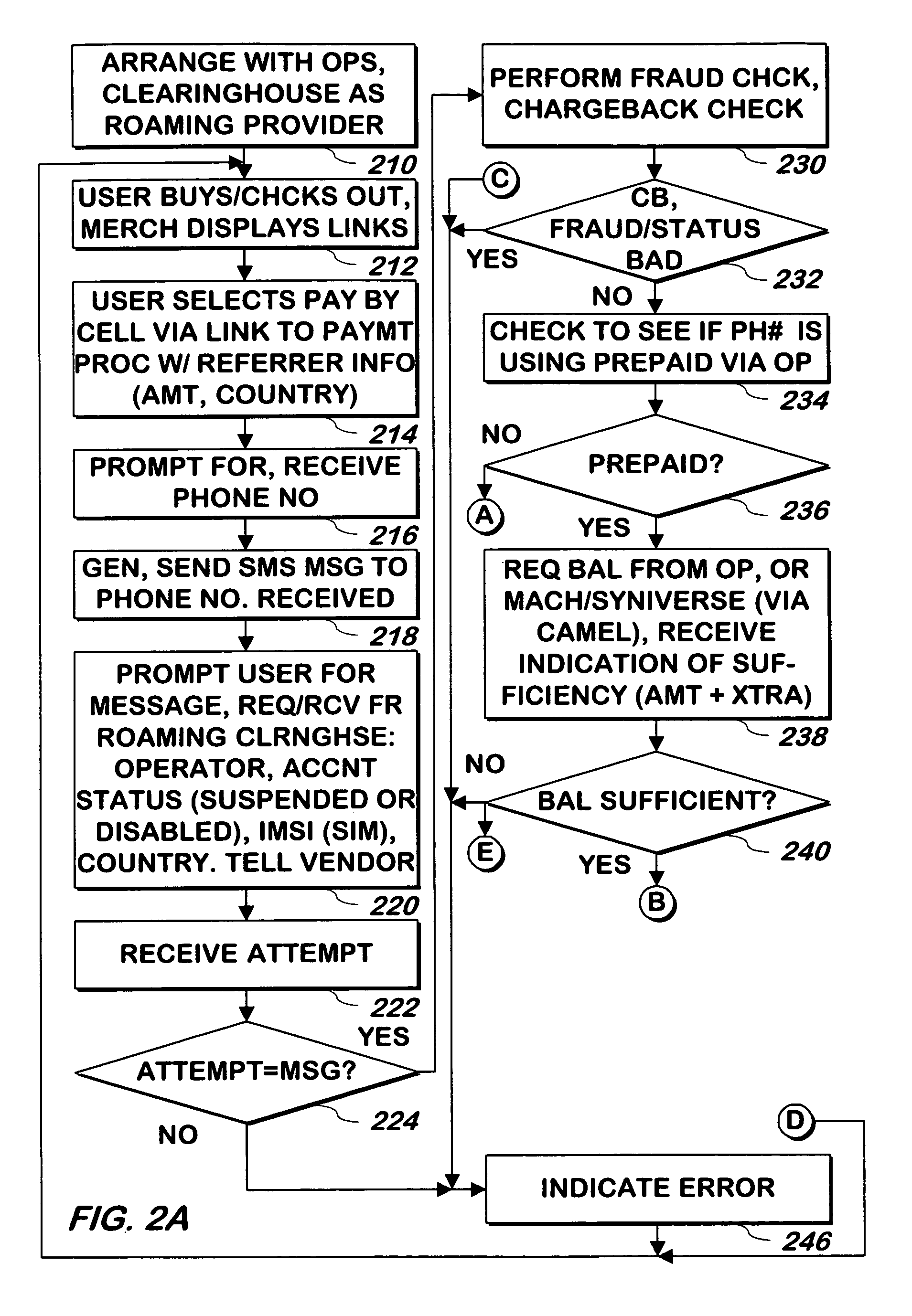

System and method for paying a merchant by a registered user using a cellular telephone account

Owner:PAYFONE

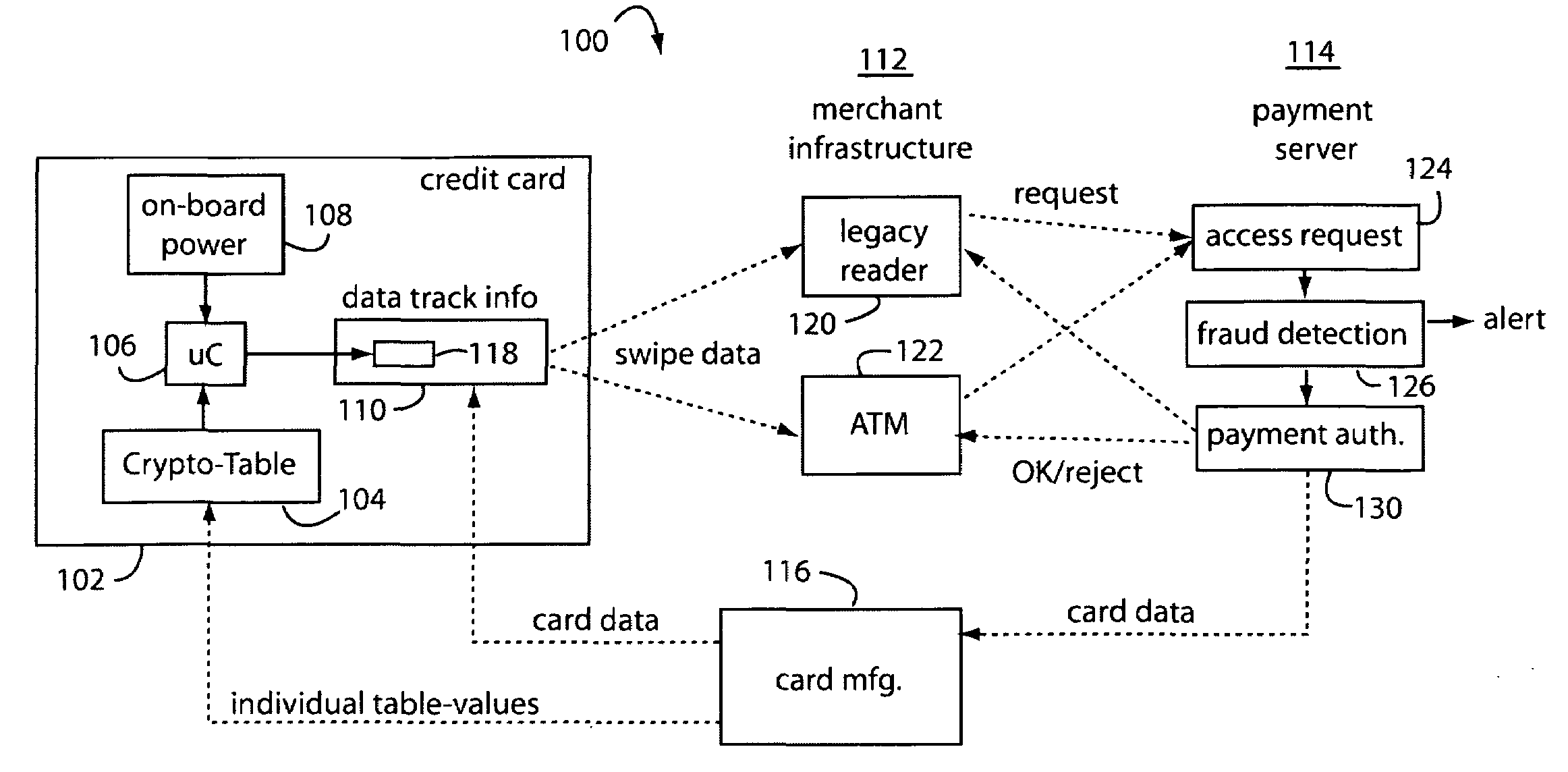

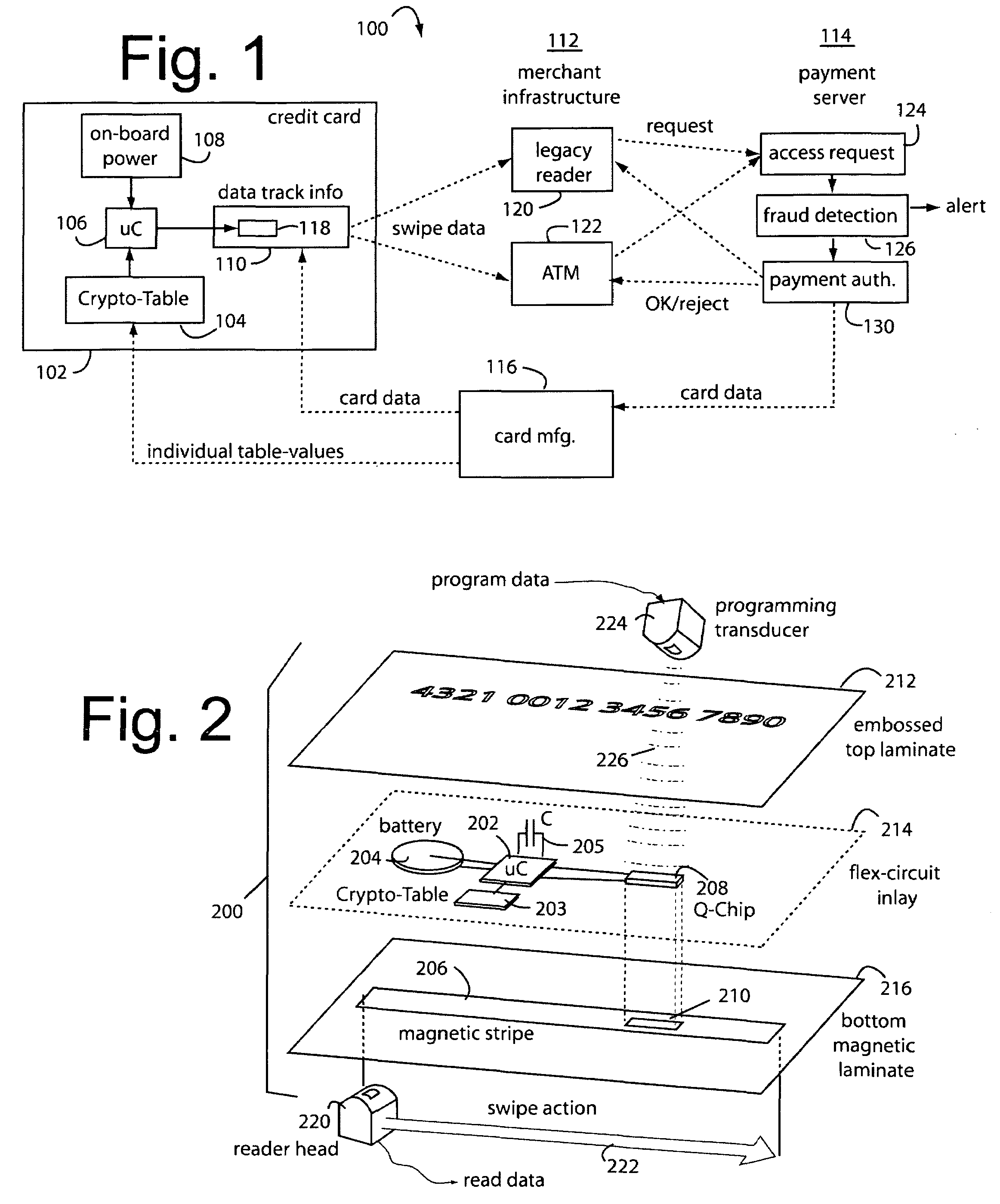

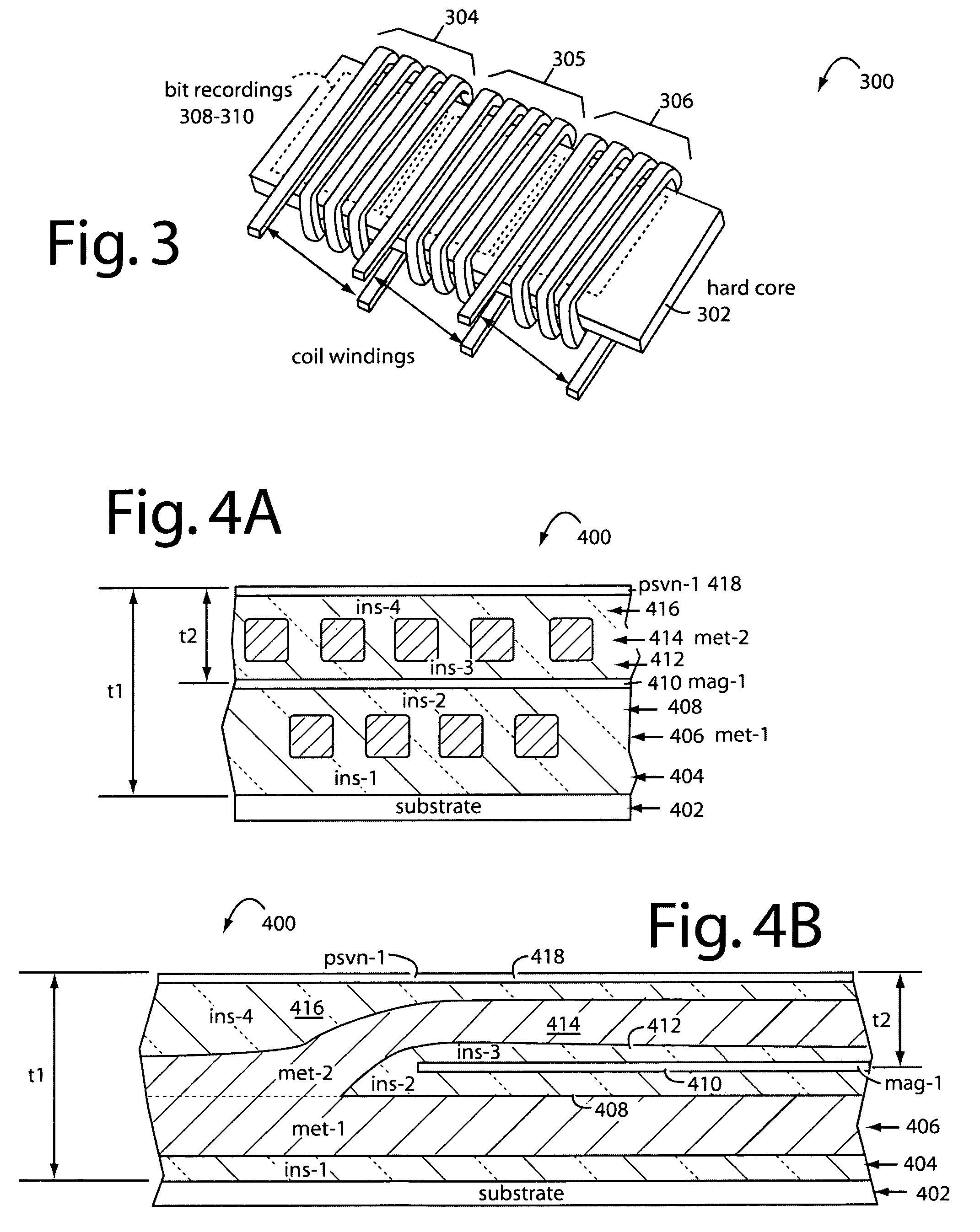

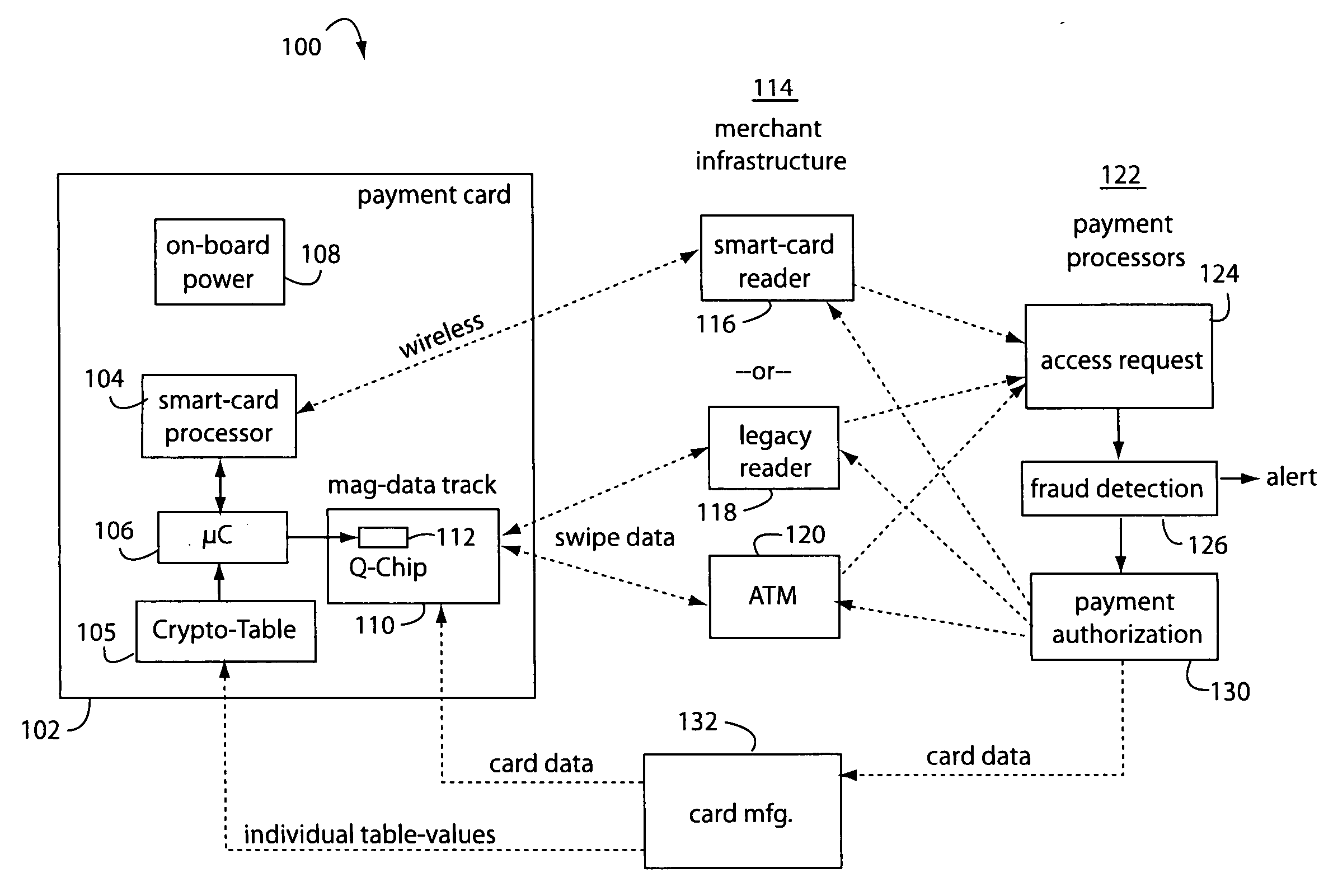

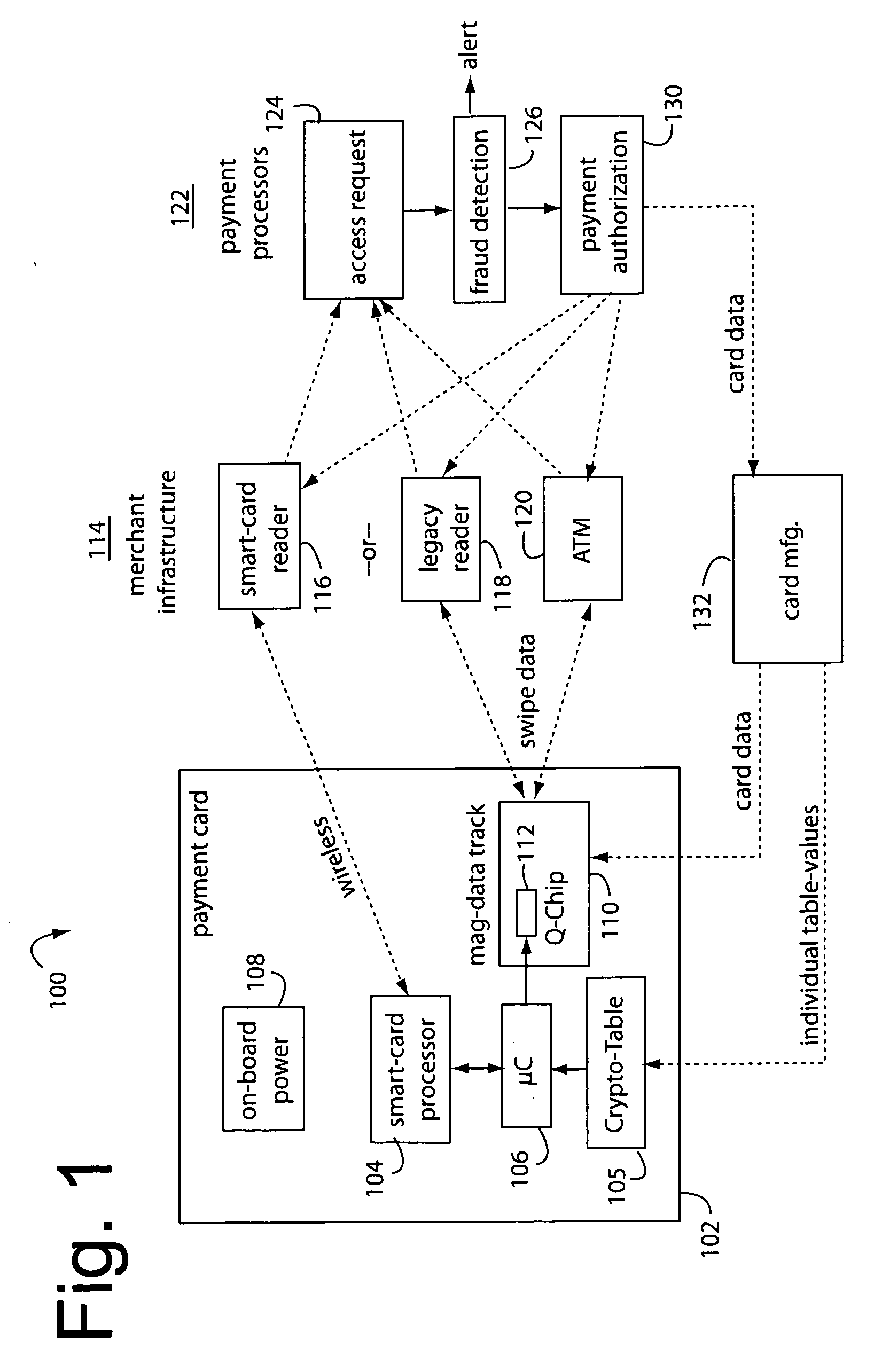

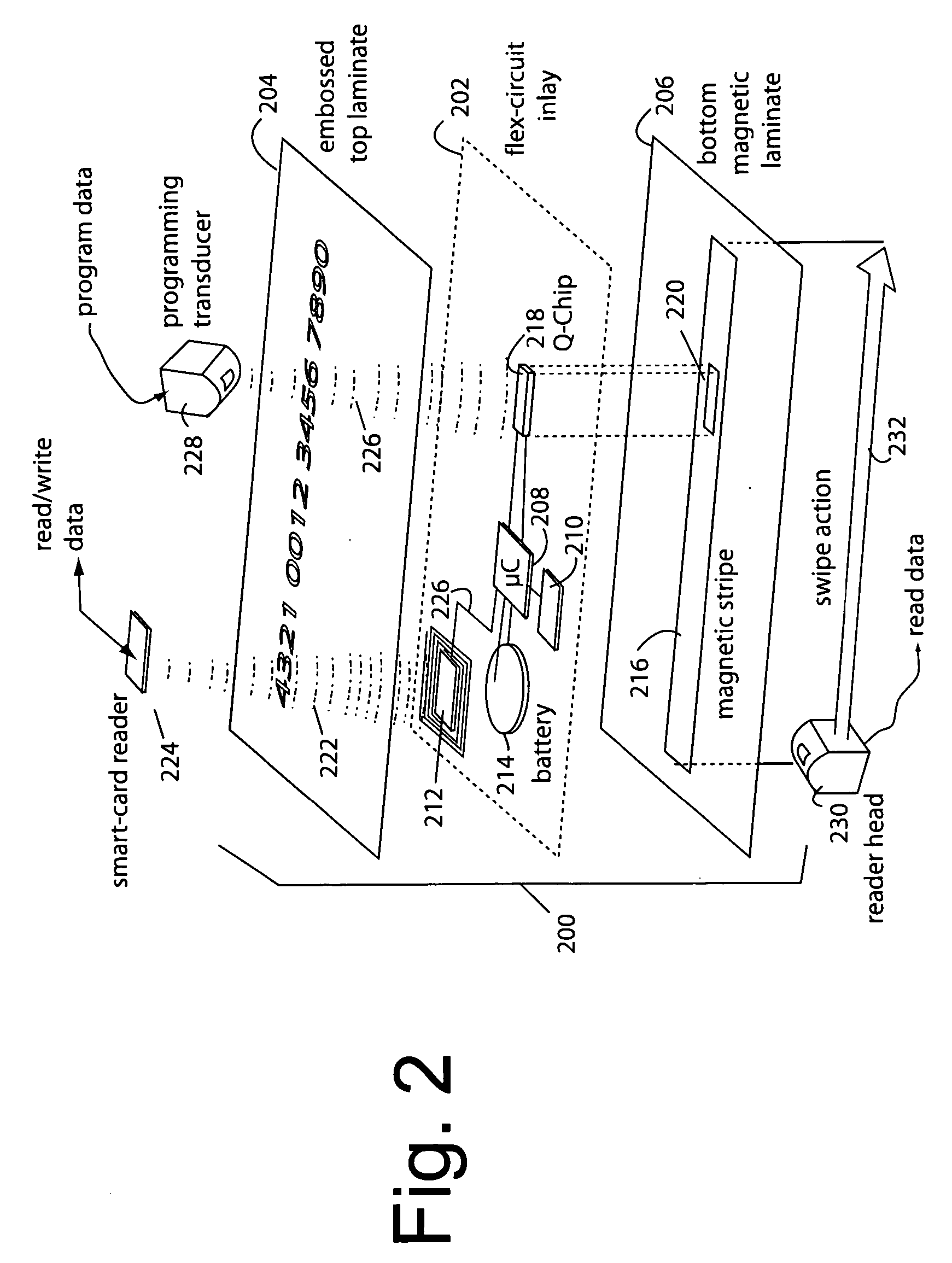

Contact/contactless and magnetic-stripe data collaboration in a payment card

InactiveUS20060287964A1Reduce loss due to fraudDebit schemesMarketingComputer hardwareData collaboration

A method of providing a magnetic-stripe type payment card with coupons and micropayment authorizations provides an internal link on a payment card between a contact / contactless processor and a MEMS magnetic device. This communicates information received from a contact / contactless payments infrastructure to be presented to a magnetic stripe payments infrastructure as specially recorded data bits written by the MEMS magnetic device in a magnetic stripe track.

Owner:FITBIT INC

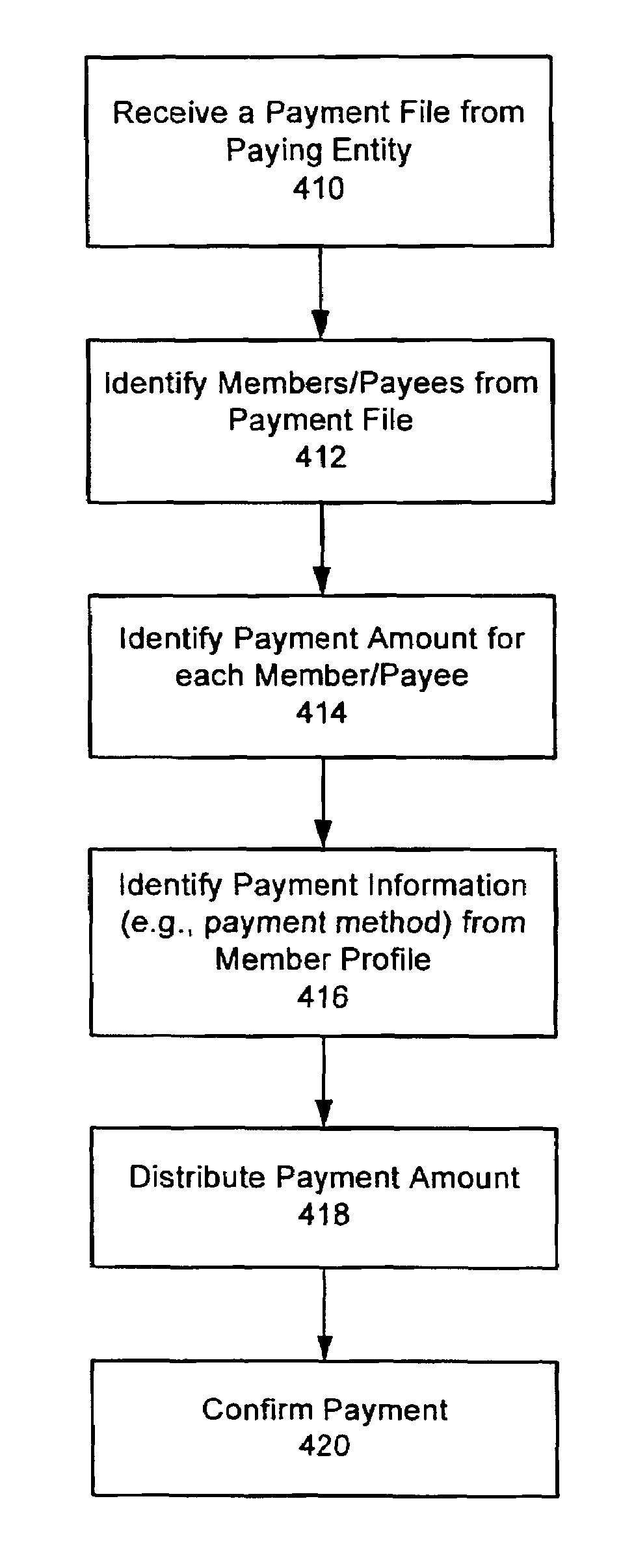

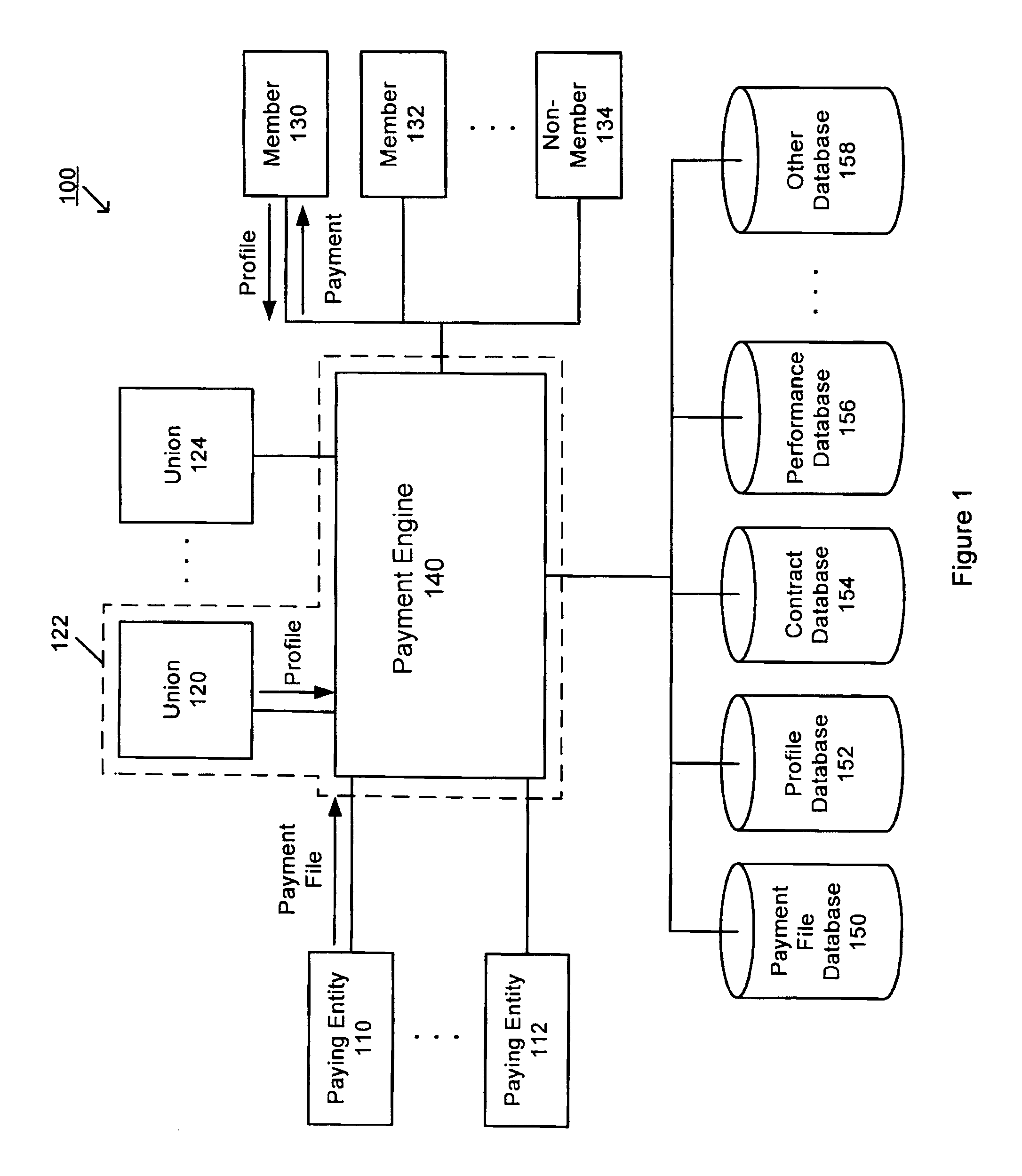

Method and system for processing recurring payments

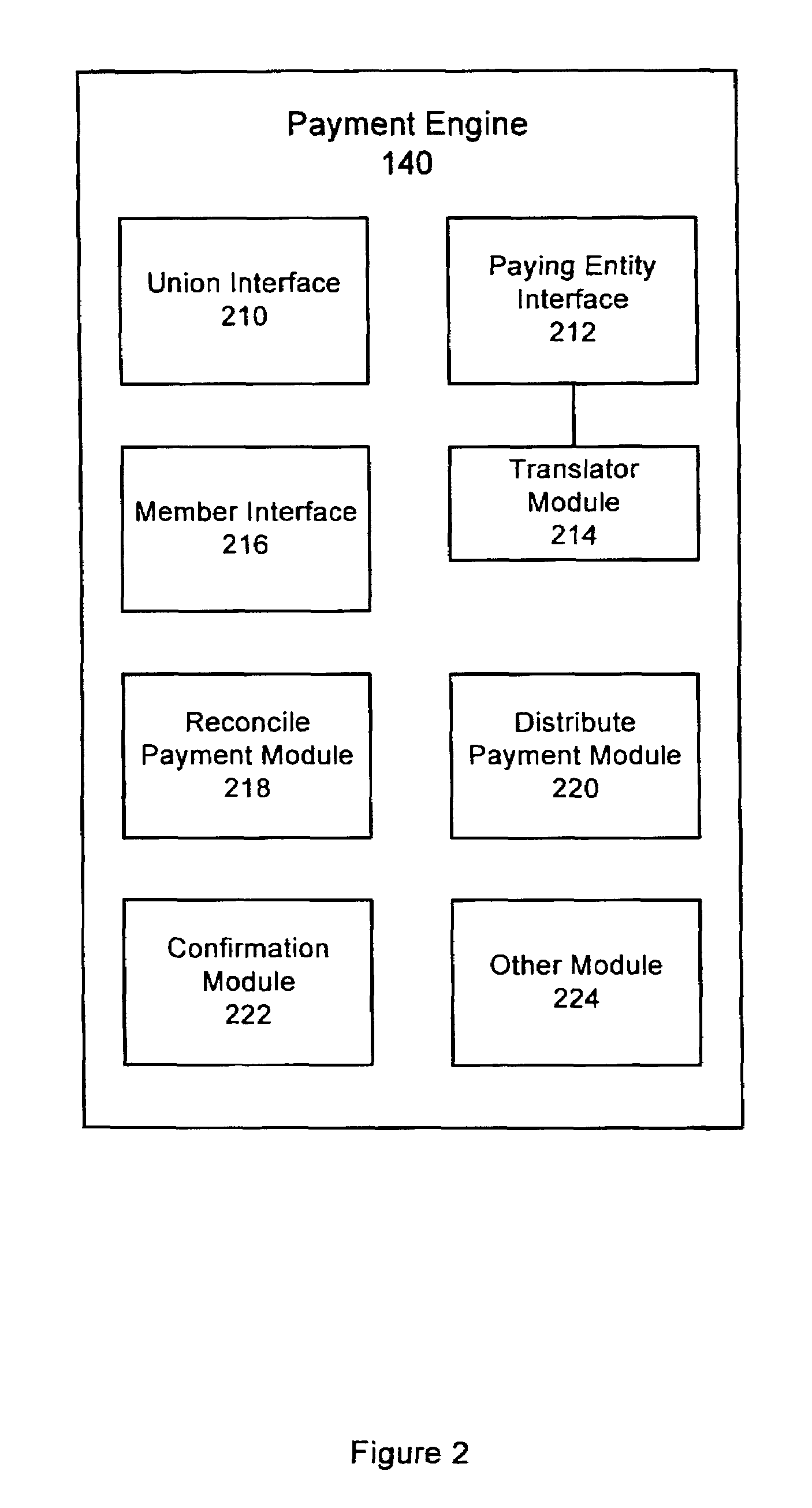

According to an embodiment of the present invention, a computer implemented method and system for processing payments may involve receiving a payment file from a paying entity; identifying at least one payee from the payment file; identifying a payment amount for the at least one payee for a contribution based on a pre-existing contract between the paying entity and the at least one payee for recurring payments to the at least one payee; identifying a payment method for the at least one payee from a payee profile; and distributing the payment amount via the payment method to the at least one payee; wherein a group manages the recurring payments for the at least one payee.

Owner:JPMORGAN CHASE BANK NA

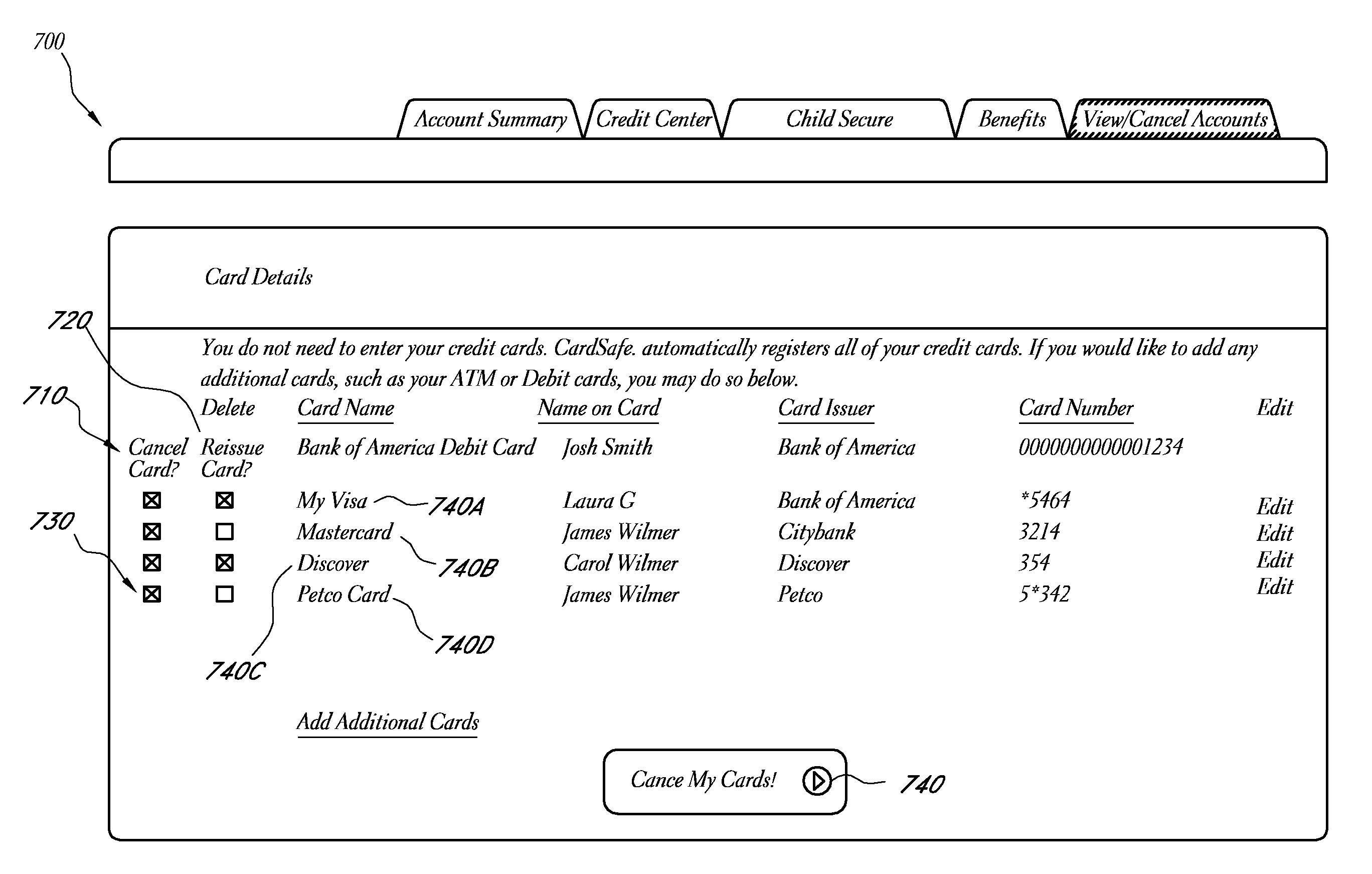

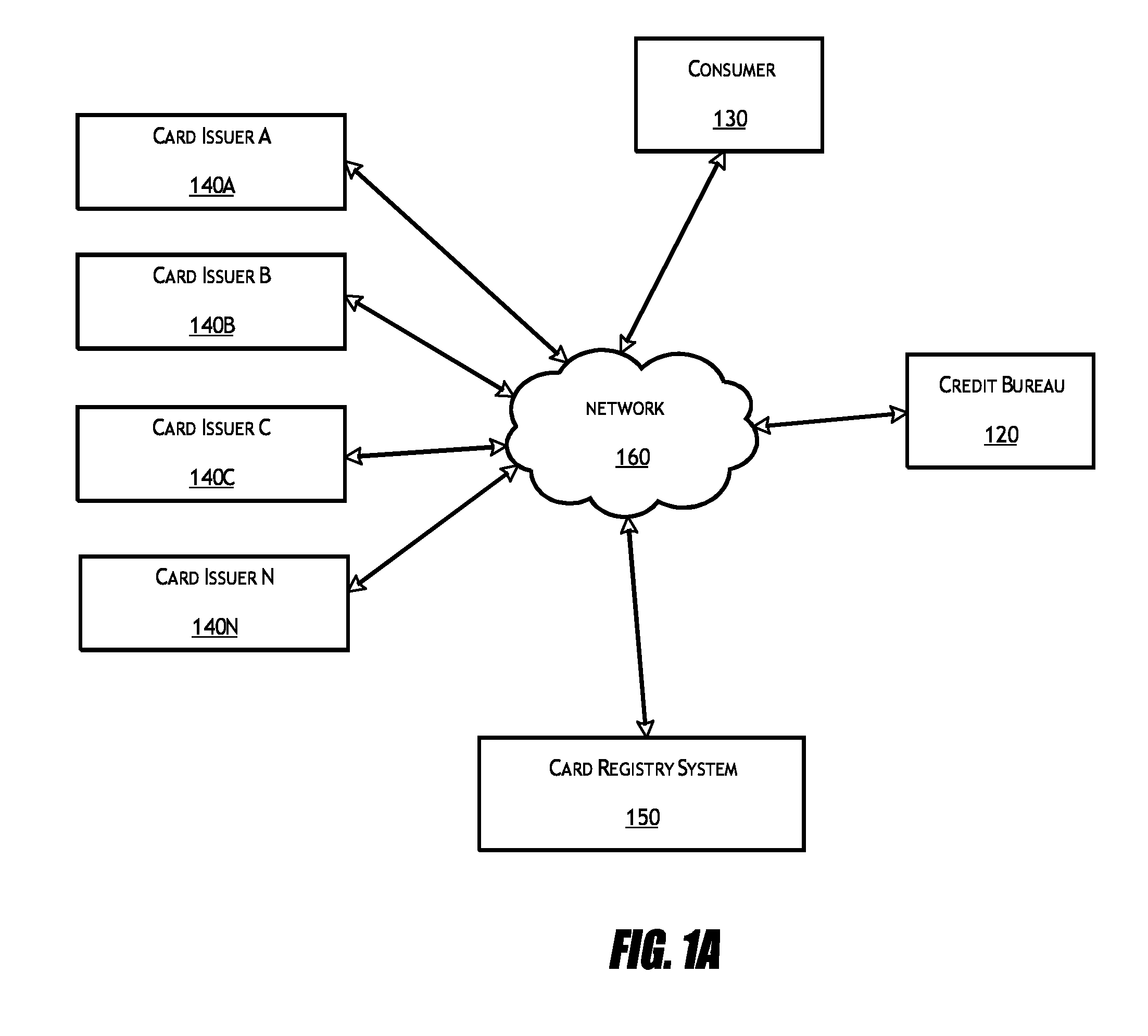

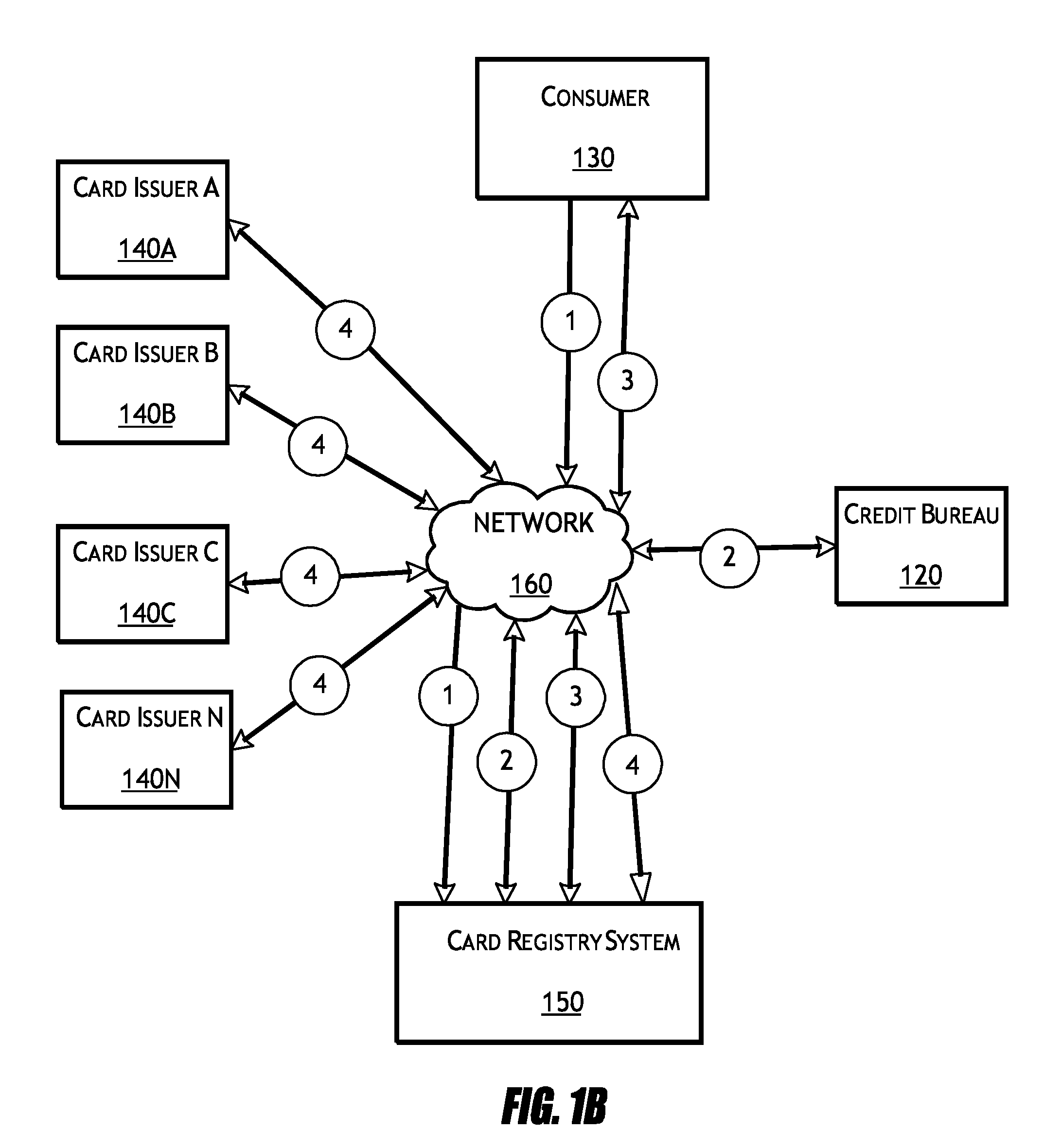

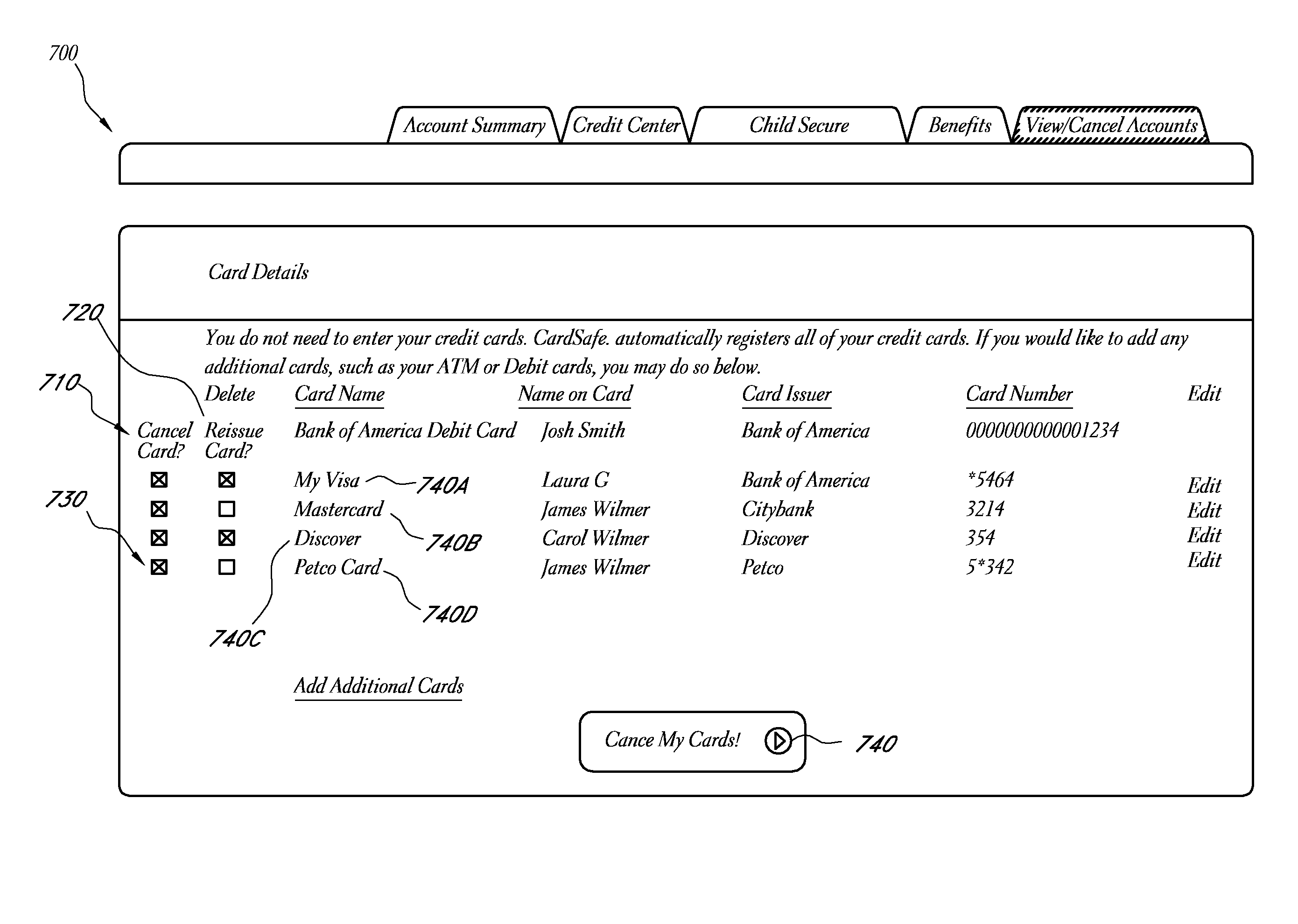

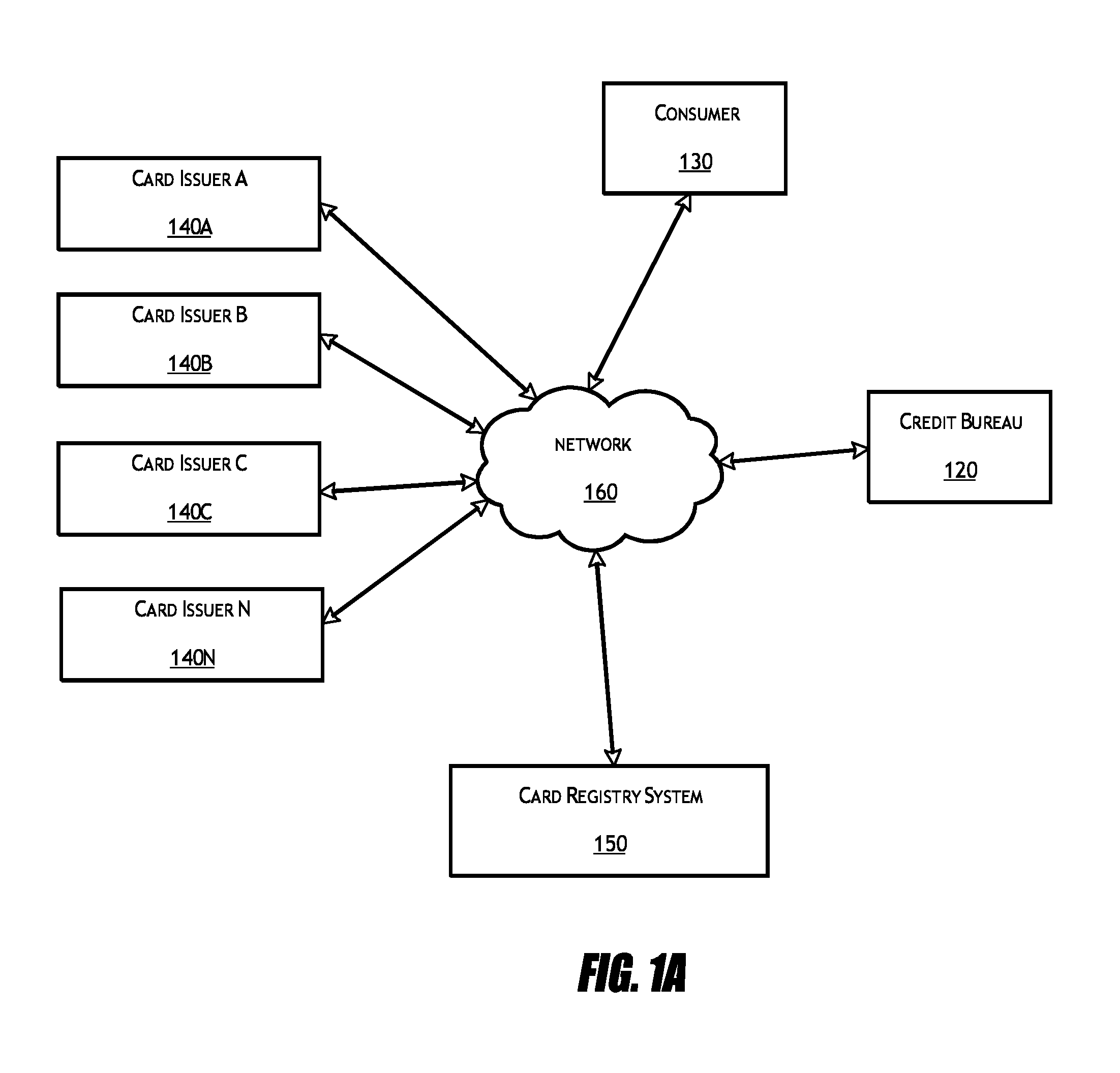

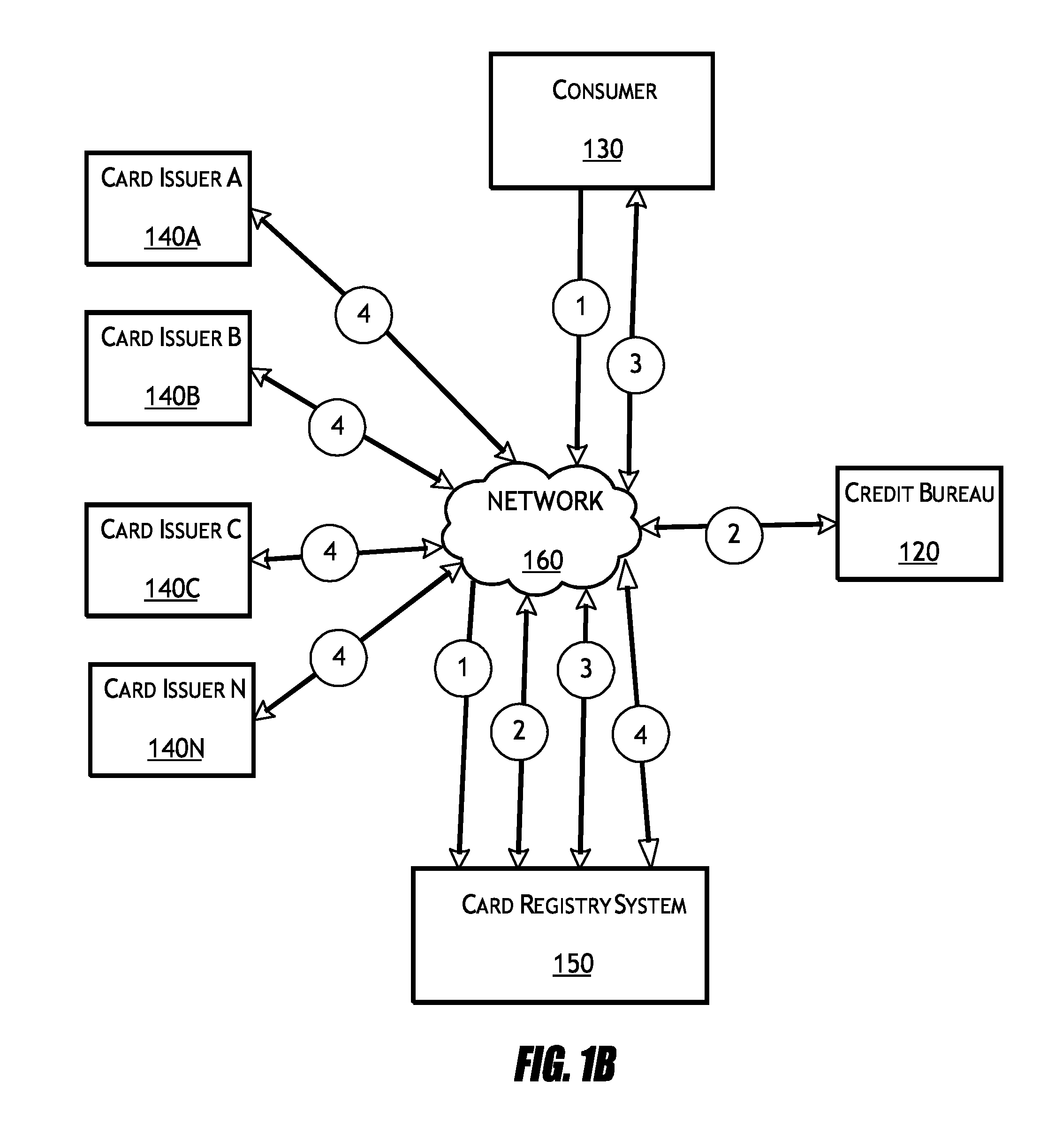

Card registry systems and methods

A card registry system is configured to automatically identify financial card information in one or more credit files associated with a consumer and populate a card registry account of the consumer with the identified financial card information. Once the financial card information has been obtained from the credit file(s), the card registry system may transmit cancellation and / or reissuance requests to the respective card issuers in the instance that one or more cards are compromised, so that the financial cards may be easily and efficiently cancelled and / or reissued at the request of the consumer.

Owner:CONSUMERINFO COM

Method and system for data management in electronic payments transactions

ActiveUS7024174B2Reduces charge-backsEliminate the problemUnauthorised/fraudulent call preventionEavesdropping prevention circuitsPayment transactionThe Internet

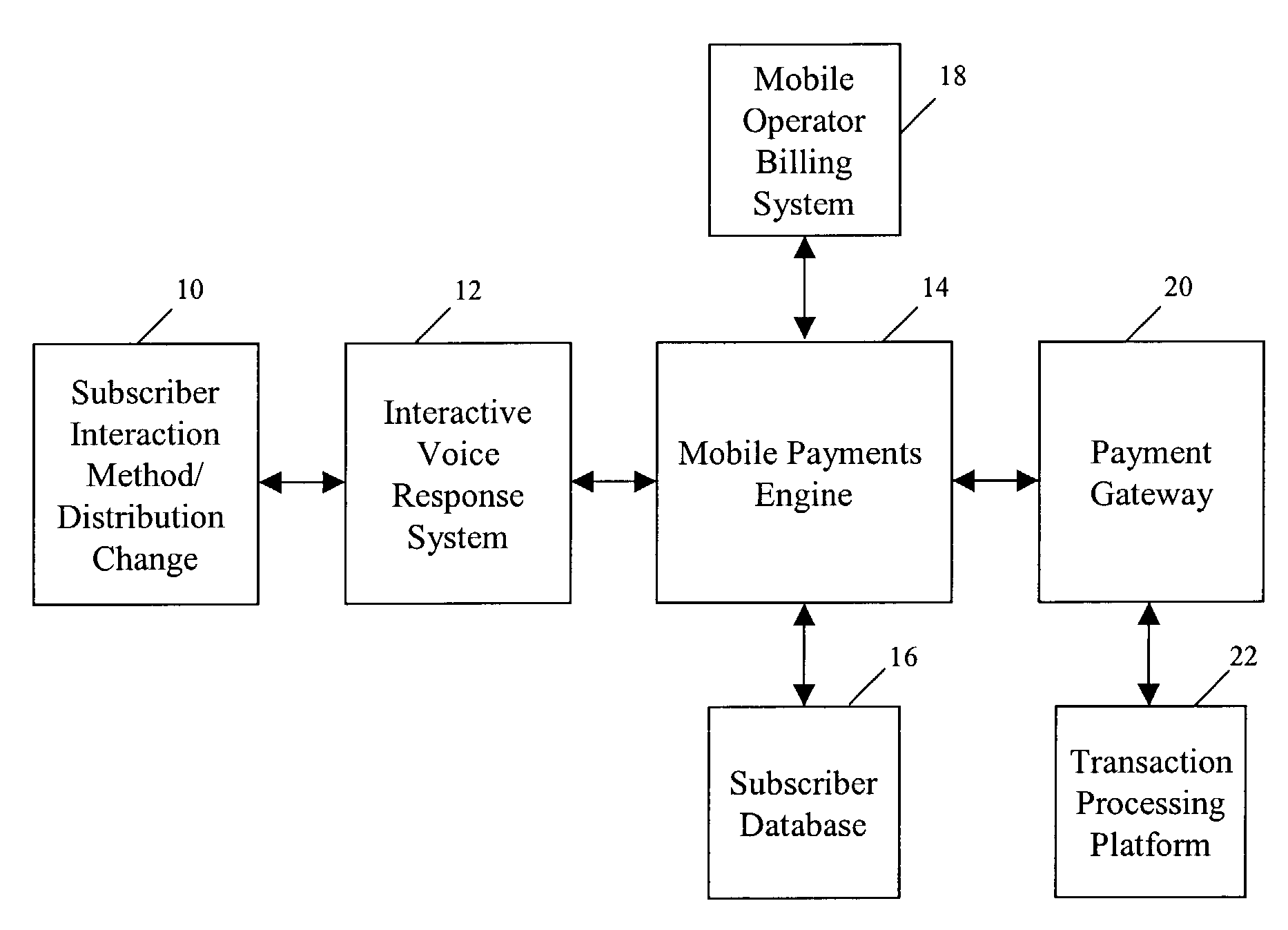

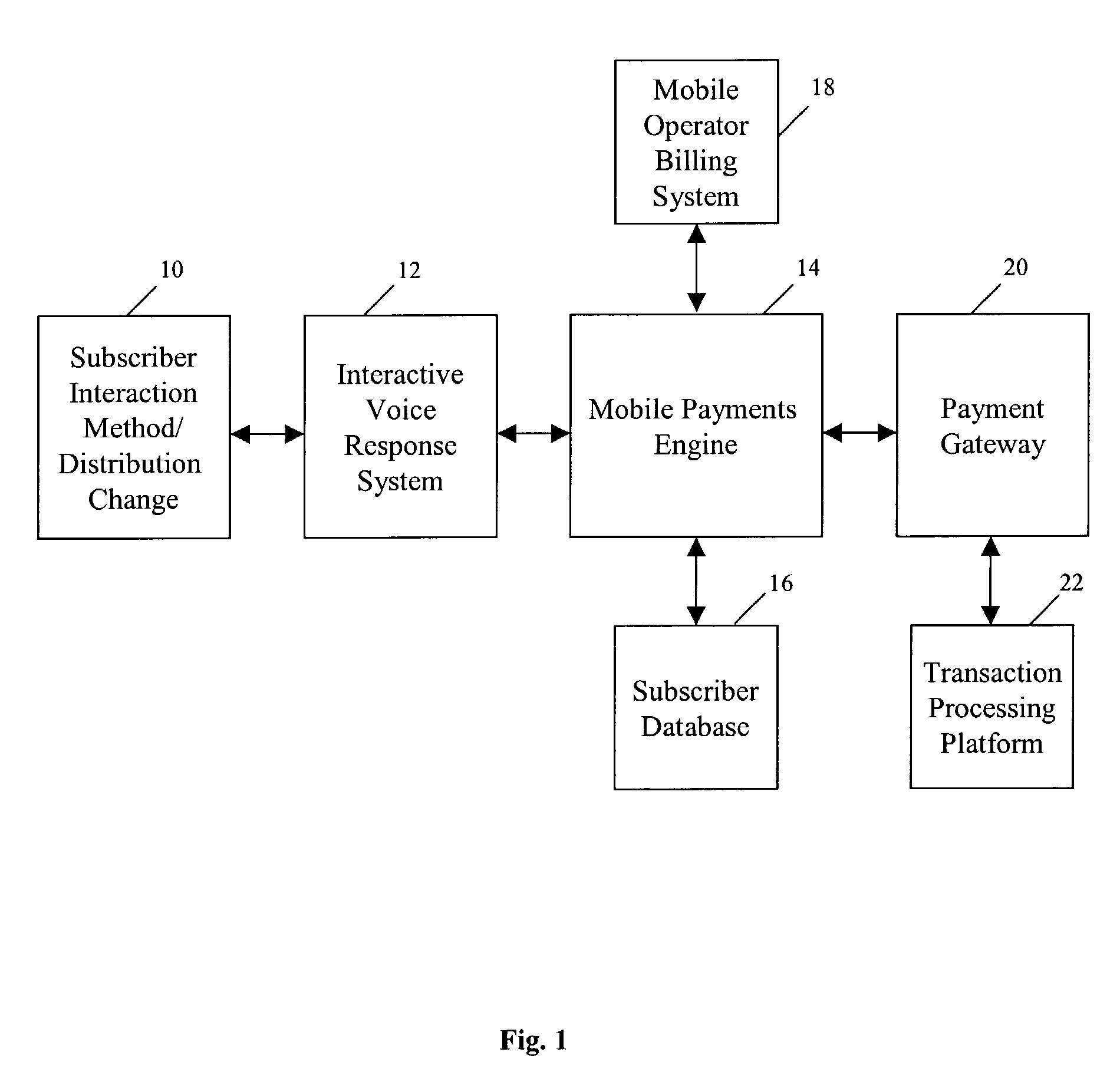

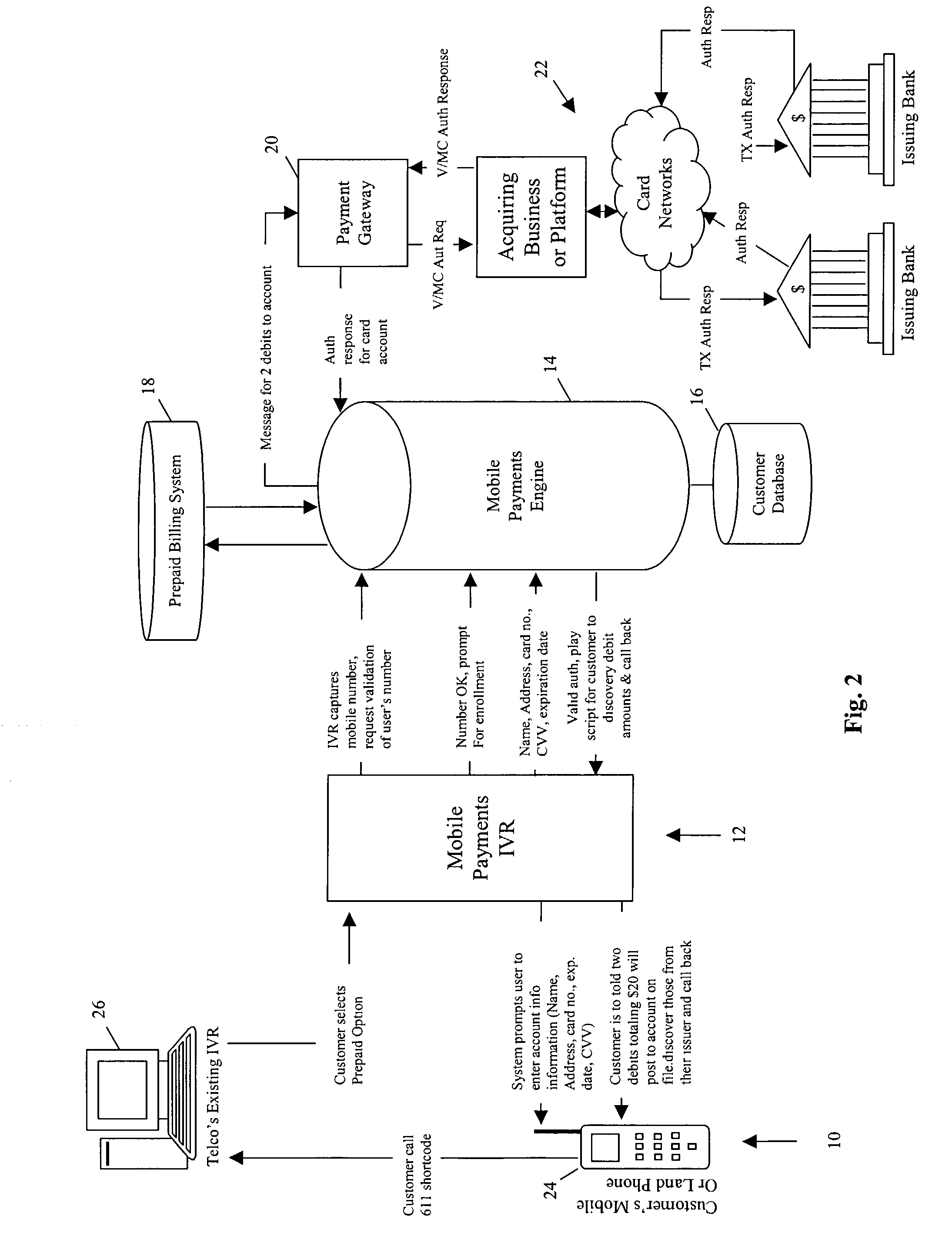

A method and system for prepaying wireless telecommunications charges utilizes computer hardware and software including, for example, a user's mobile phone, a mobile operator's interactive voice response unit, a mobile payments interactive voice response unit, SMS, test messaging, email, ATM, kiosk, the Internet, and / or WAP or the like, a mobile payments engine, a mobile operator's prepaid billing system, a subscriber database, a payment gateway, and a transaction processing platform. The mobile payments engine receives information identifying a user's wireless telecommunication device via the mobile payments interactive voice response unit, passes the information to the mobile operator's billing system with a request for validation of a mobile account for the user, and if validation is received, the mobile payments engine receives financial source account and user identity verification information from the user, assigns a mobile personal identification number for the user, and arranges a credit from the source account to the user's mobile account.

Owner:CITIBANK

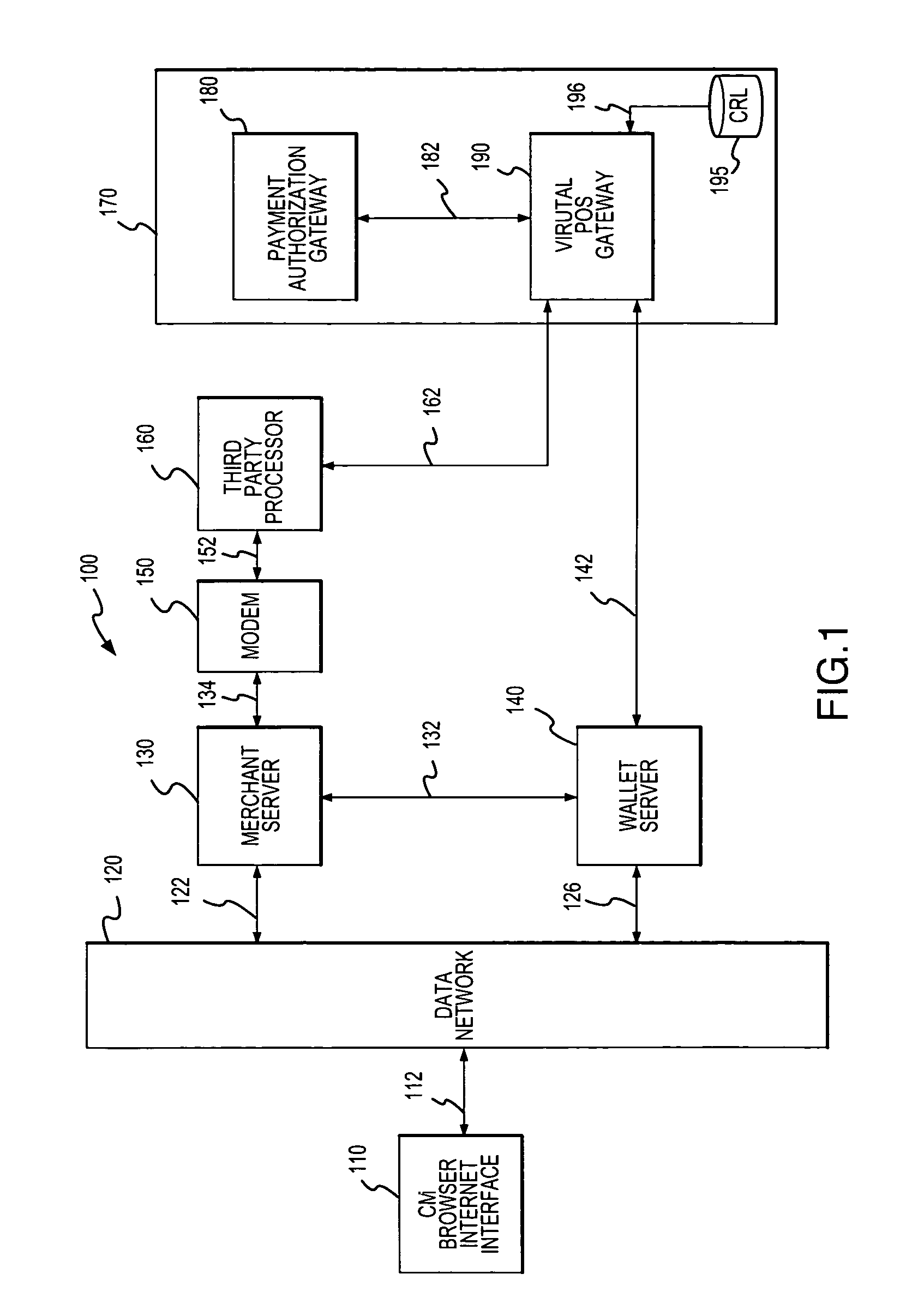

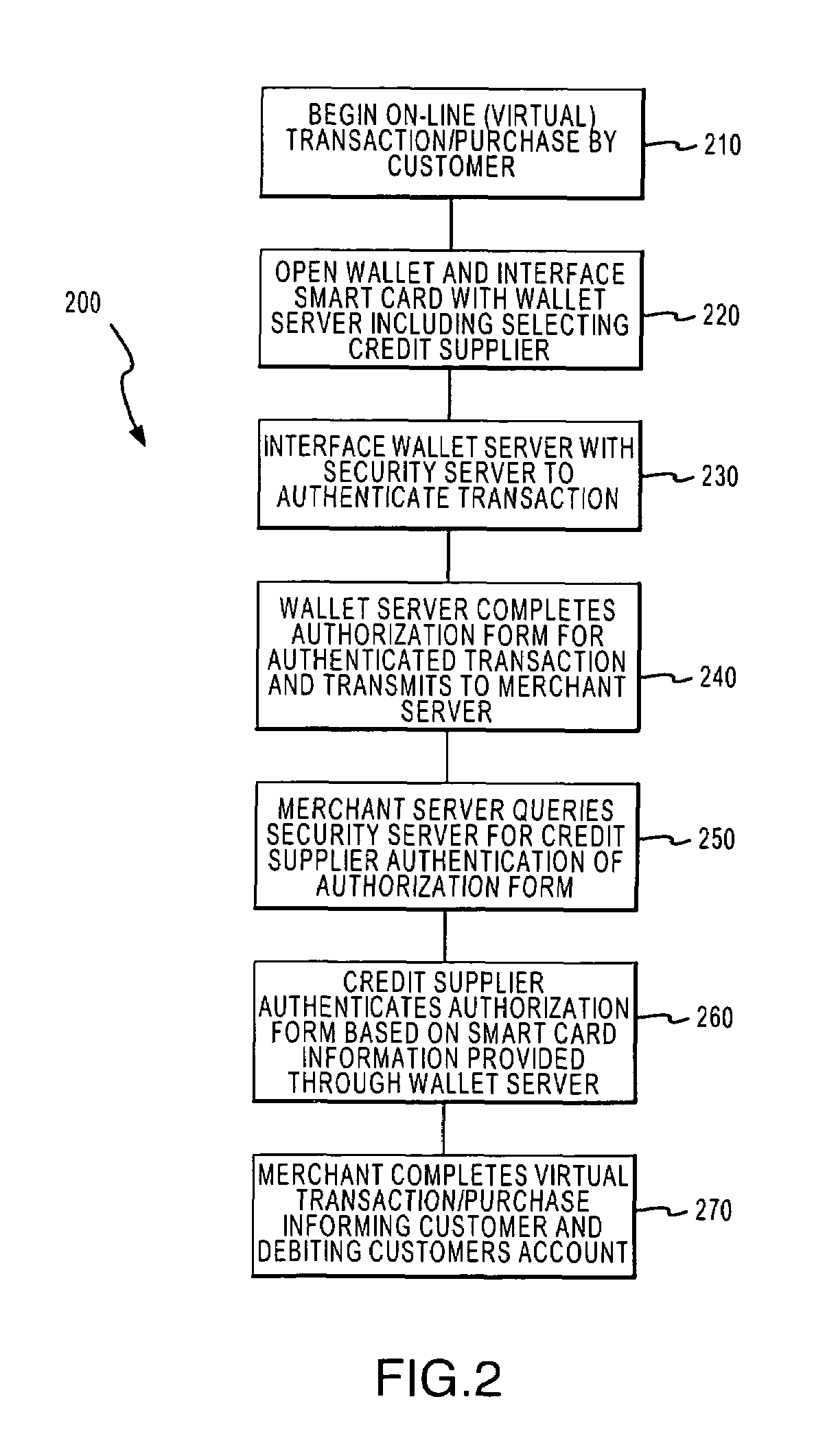

Smartcard internet authorization system

InactiveUS7366703B2Enhanced reliability and confidenceLow costDebit schemesSecret communicationTTEthernetThe Internet

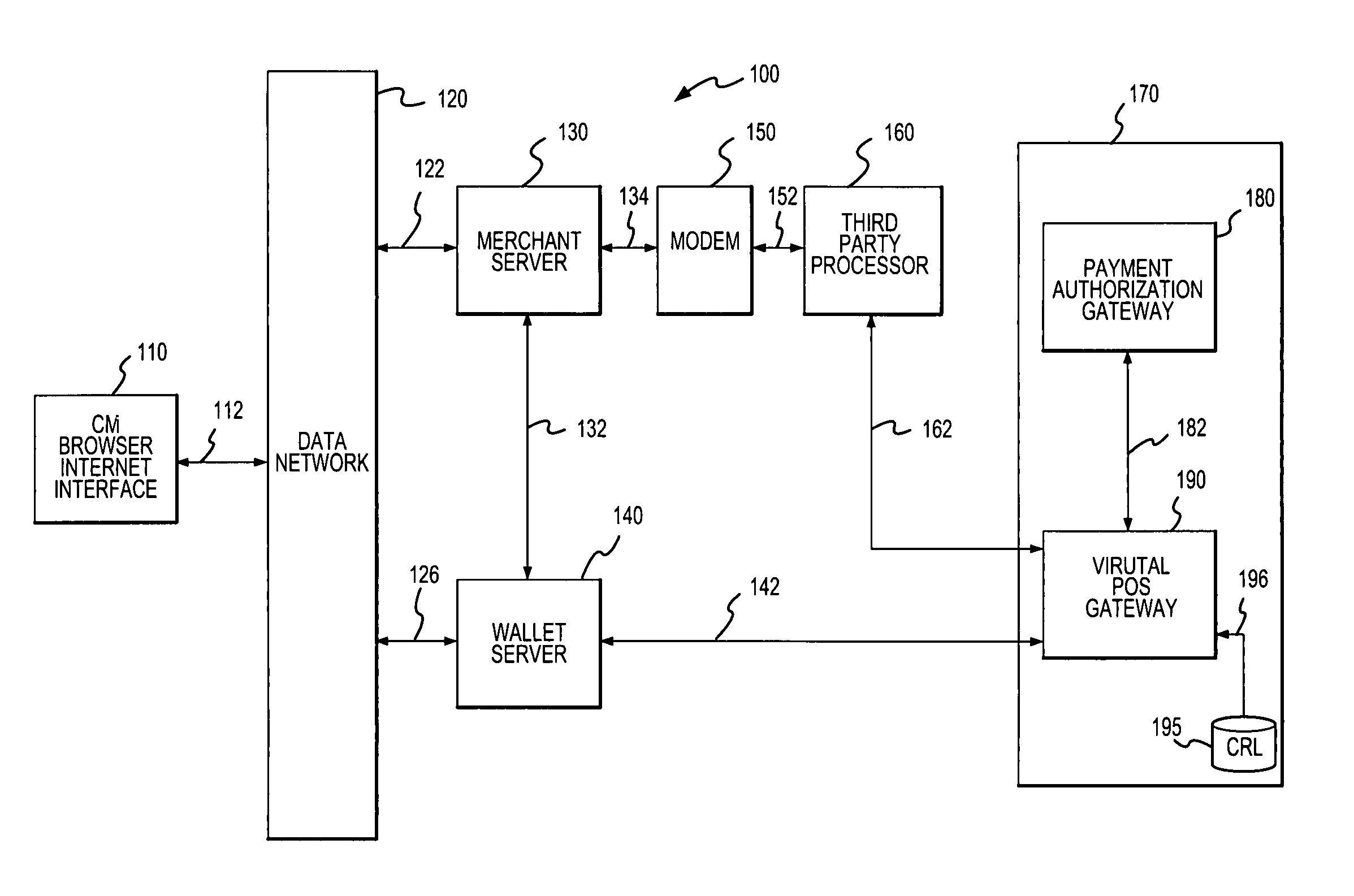

A system and method are disclosed for conducting electronic commerce such as a virtual purchase transaction with an on-line merchant. A user is provided with an intelligent token, such as a smart card containing a digital certificate. The intelligent token suitably authenticates with a wallet server on a network that conducts all or portions of the transaction on behalf of the user with out requiring changes to the merchant's server. The wallet server interacts with a security server of a selected financial service to provide authentication of the transaction. Upon authentication, the digital wallet pre-fills forms which are transmitted to the merchant who contacts the security server for validation of the forms and upon validation, completes the transaction with the user.

Owner:LIBERTY PEAK VENTURES LLC

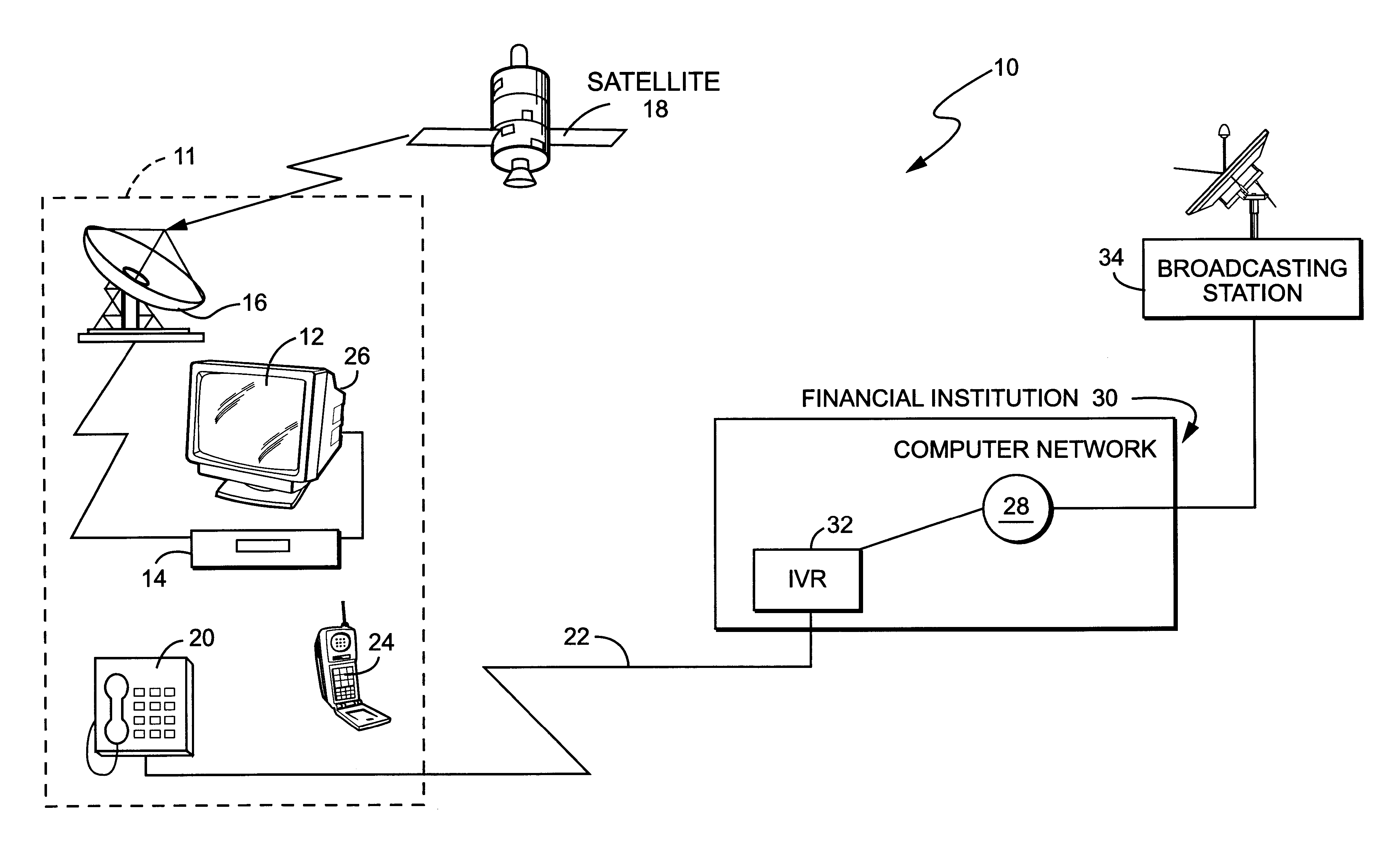

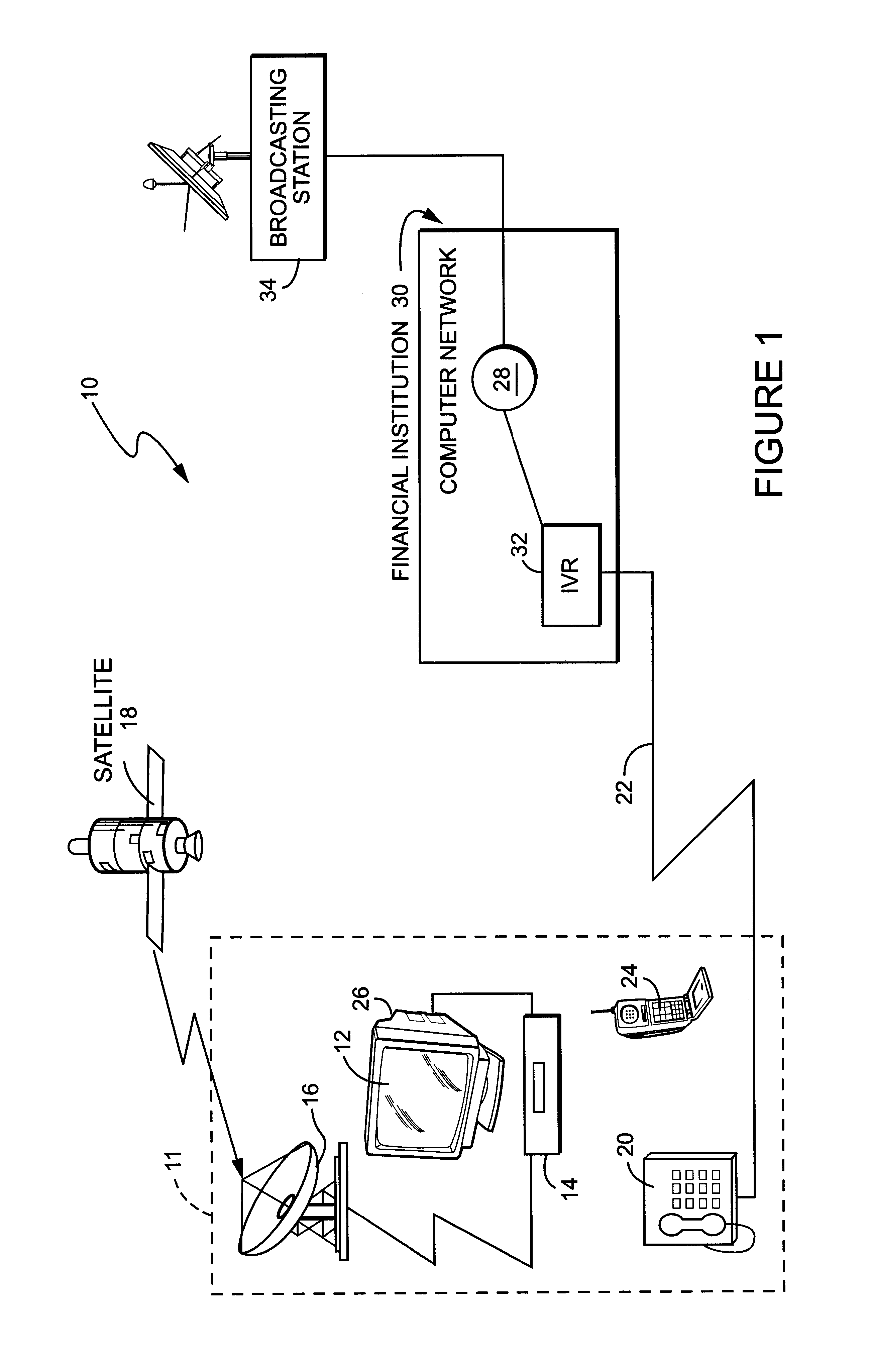

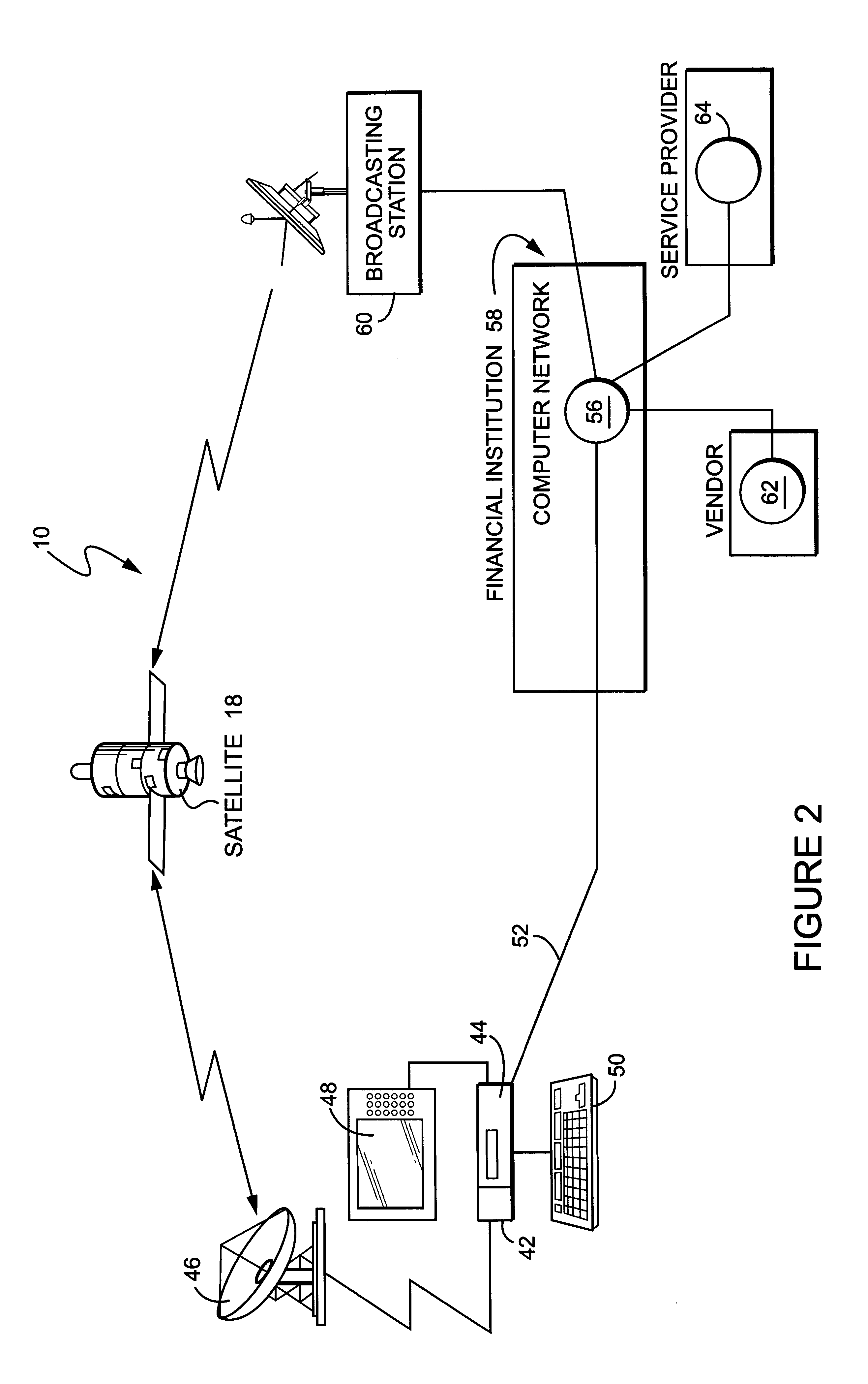

Interactive system for and method of performing financial transactions from a user base

There is disclosed and claimed a system for and a method of performing interactive data exchange, for example as part of a financial transaction, between a user base and a remote network. The system includes a request data input device 20. A telephone network 22 is connected to the device for transmitting the request data to the network 28. At the user base there is also provided a receiver for receiving response signals from the network and which signals include encoded response data. A signal decoder 14 is provided at the user base to decode the response data. A display 12 displays the response data interactively with the request data.

Owner:IPEG LLC

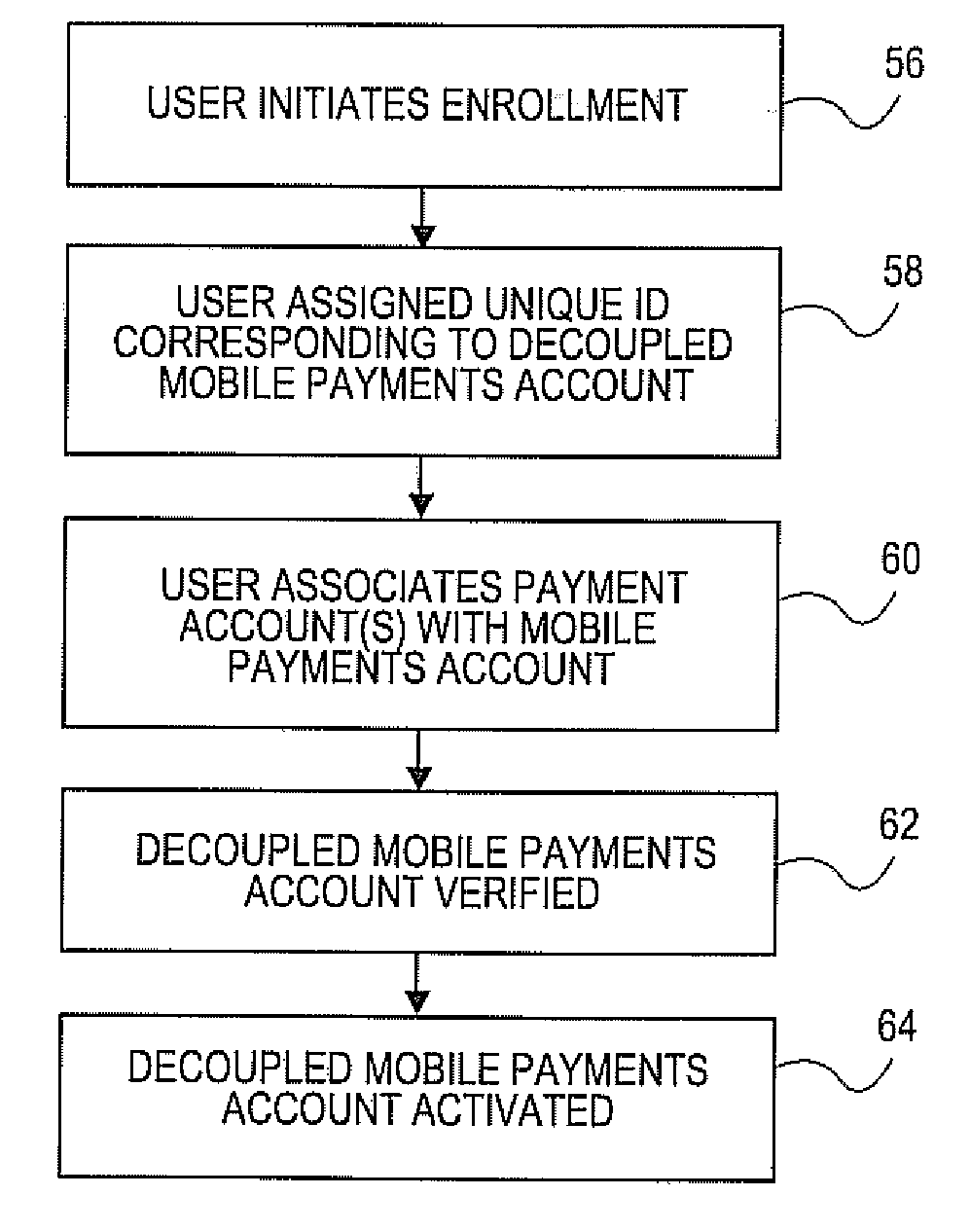

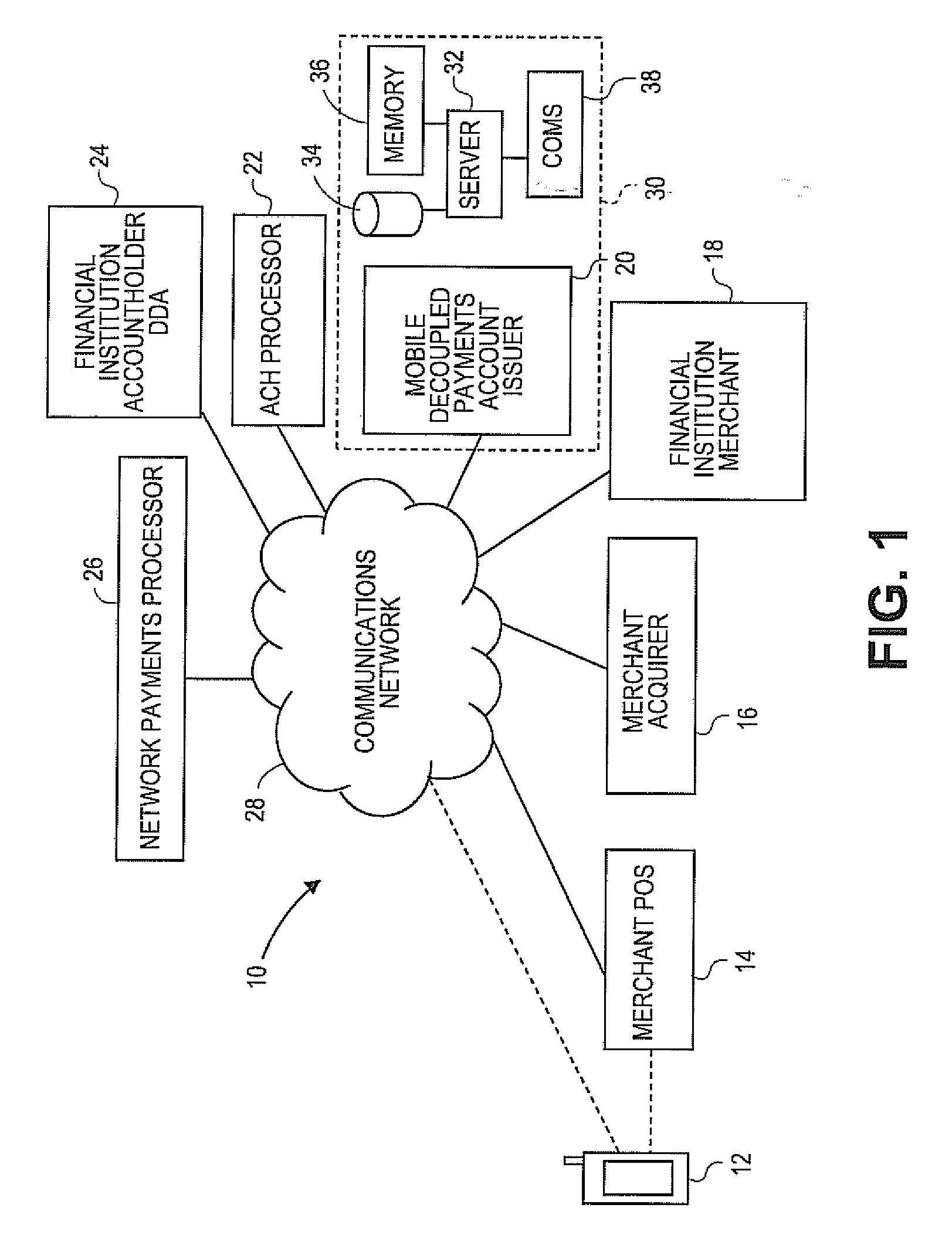

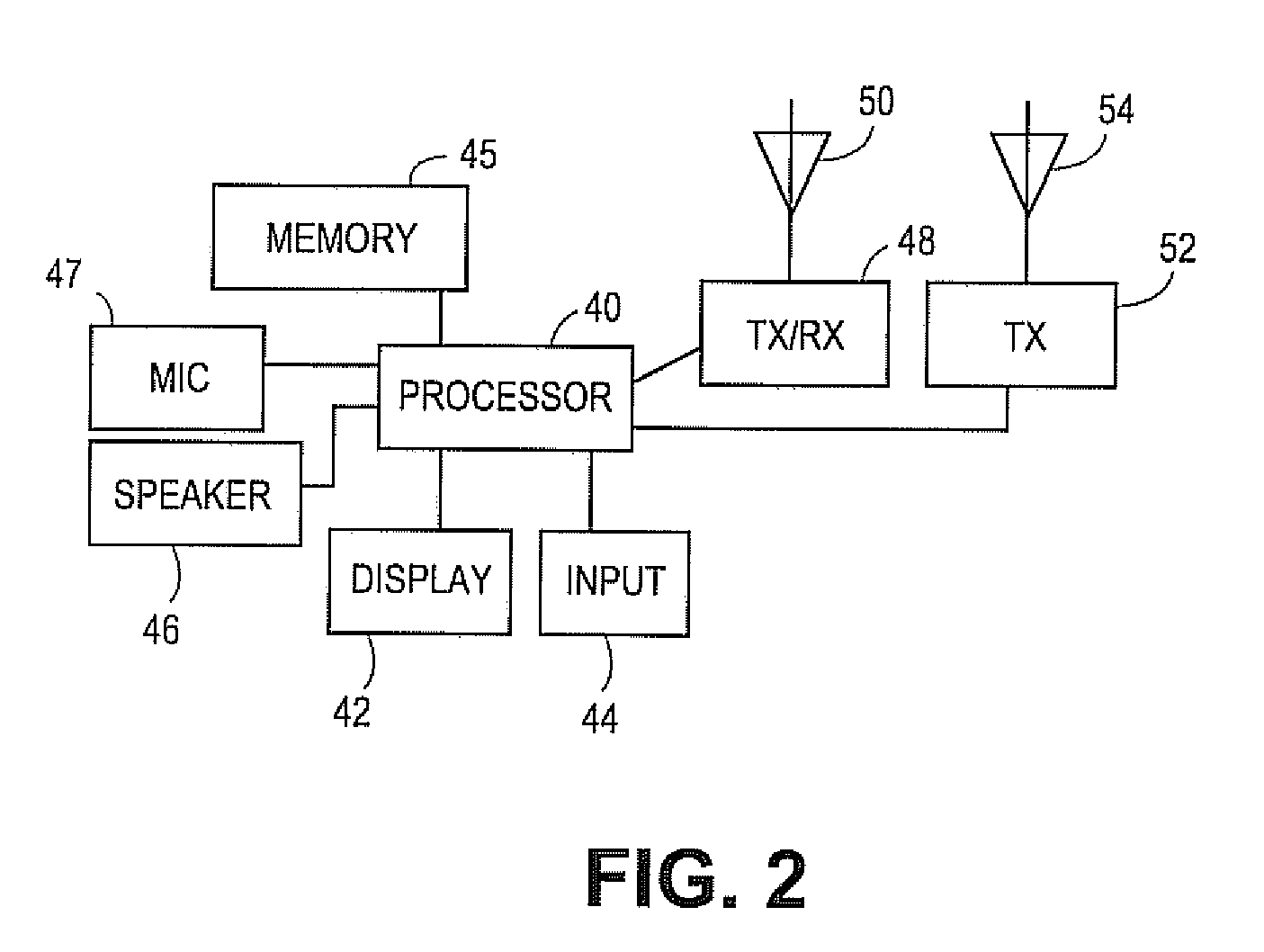

Systems, methods and devices for facilitating mobile payments

Mobile decoupled payments account systems and computer-implemented methods provide a decoupled mobile payments account and processing for payments made with a decoupled mobile payments account. A demand deposit account of an accountholder is associated with a decoupled mobile payments account that enables a mobile device to be used in making proximity or remote payments. Embodiments include mobile decoupled payments accounts based upon open or closed loop processing networks and mobile decoupled payments accounts that are ACH-direct accounts. An issuer of the mobile decoupled payments account authorizes or declines transactions and, for approved transactions, initiates an ACH transaction to obtain funds corresponding to an approved purchase transaction from the demand deposit account of the accountholder. Embodiments include person-to-person mobile payments and merchant-specific gifts and prioritized selection of accounts associated with a decoupled mobile payments account for processing a purchase transaction made with a mobile device.

Owner:GOFIGURE PAYMENTS

Electronic device cover with embedded radio frequency (RF) reader and method of using same

InactiveUS20050040951A1Improve standardsEliminate disadvantagesElectric signal transmission systemsDigital data processing detailsTransceiverElectronic identification

A changeable cover for an electronic device and method of using same in a payment system is provided. The cover has a transponder responsive to interrogation by an electric field. The cover provides an electronic identification number and other information in response to the interrogation signal. Also provided is a system for making payments, comprising at least one mobile station (4) which has an associated cover (100) for providing local data transfer. The system also comprises at least one point of sale terminal or the like, which has a second transceiver for providing data transfer.

Owner:RPX CORP

Card registry systems and methods

ActiveUS8464939B1Improve integrityEasily enrollFinanceCredit schemesComputer hardwareComputer science

A card registry system is configured to automatically identify financial card information in one or more credit files associated with a consumer and populate a card registry account of the consumer with the identified financial card information. Once the financial card information has been obtained from the credit file(s), the card registry system may transmit cancellation and / or reissuance requests to the respective card issuers in the instance that one or more cards are compromised, so that the financial cards may be easily and efficiently cancelled and / or reissued at the request of the consumer.

Owner:CONSUMERINFO COM

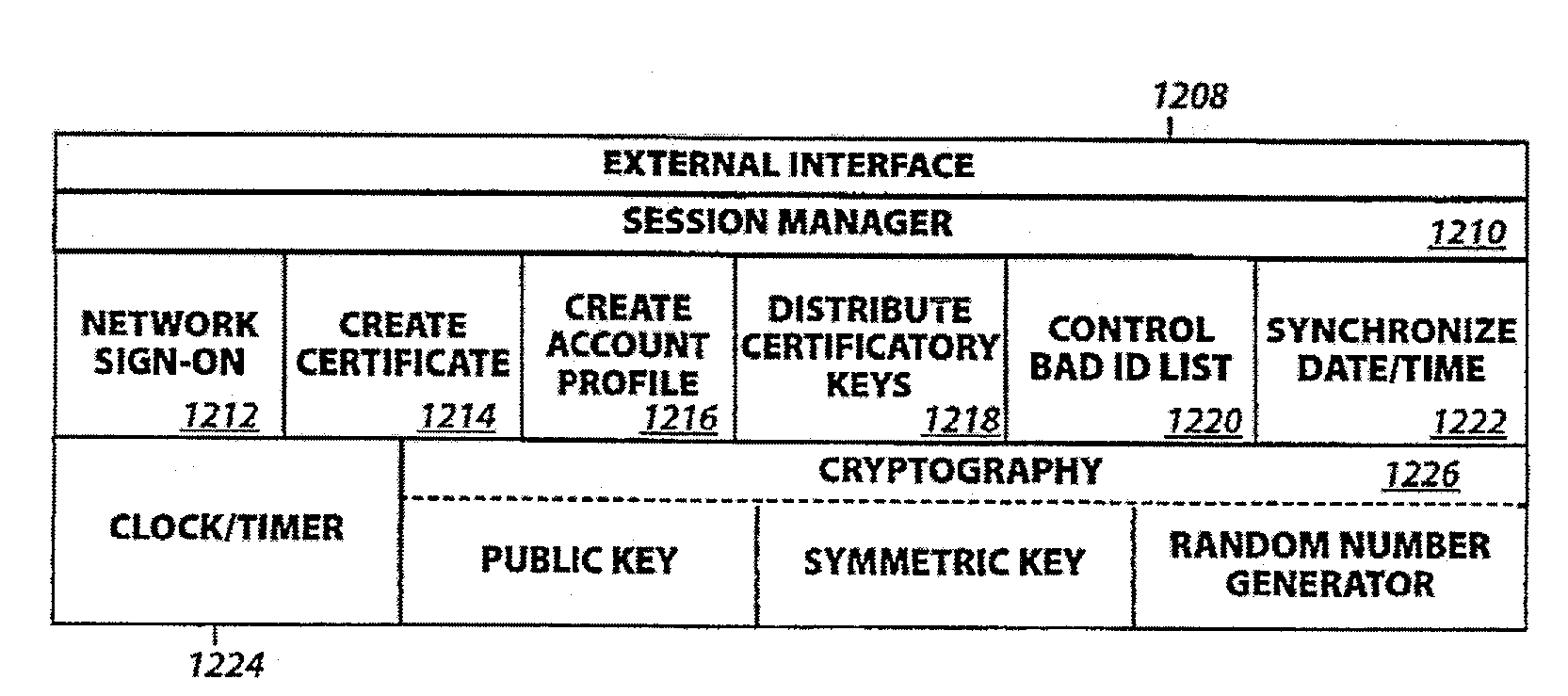

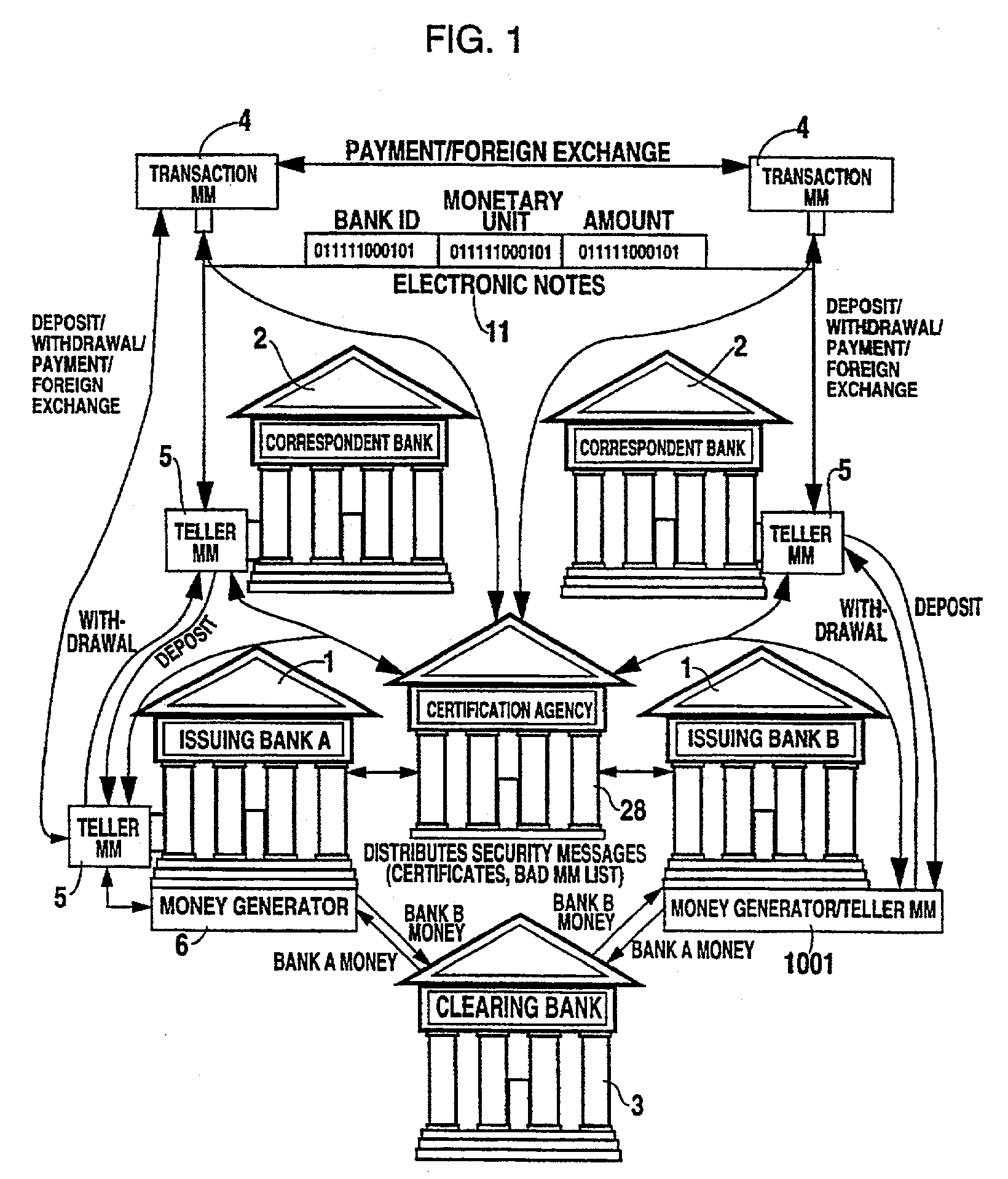

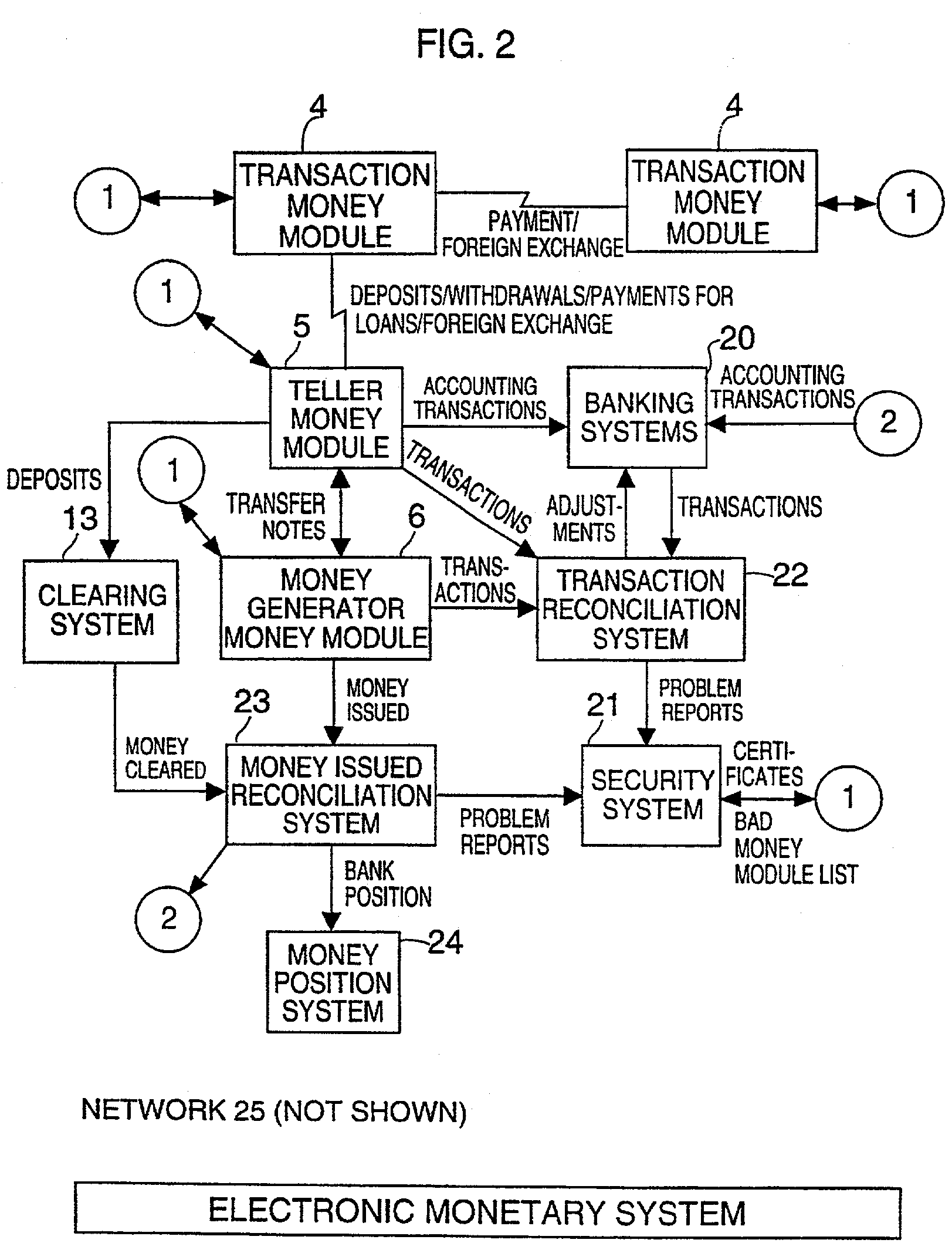

Electronic-monetary system

An improved monetary system using electronic media to exchange economic value securely and reliably is disclosed. The system provides a complete monetary system having electronic money that is interchangeable with conventional paper money. Also disclosed is a system for open electronic commerce having a customer trusted agent securely communicating with a first money module, and a merchant trusted agent securely communicating with a second money module. Both trusted agents are capable of establishing a first cryptographically secure session, and both money modules are capable of establishing a second cryptographically secure session. The merchant trusted agent transfers electronic merchandise to the customer trusted agent, and the first money module transfers electronic money to the second money module. The money modules inform their trusted agents of the successful completion of payment, and the customer may use the purchased electronic merchandise.

Owner:CITIBANK

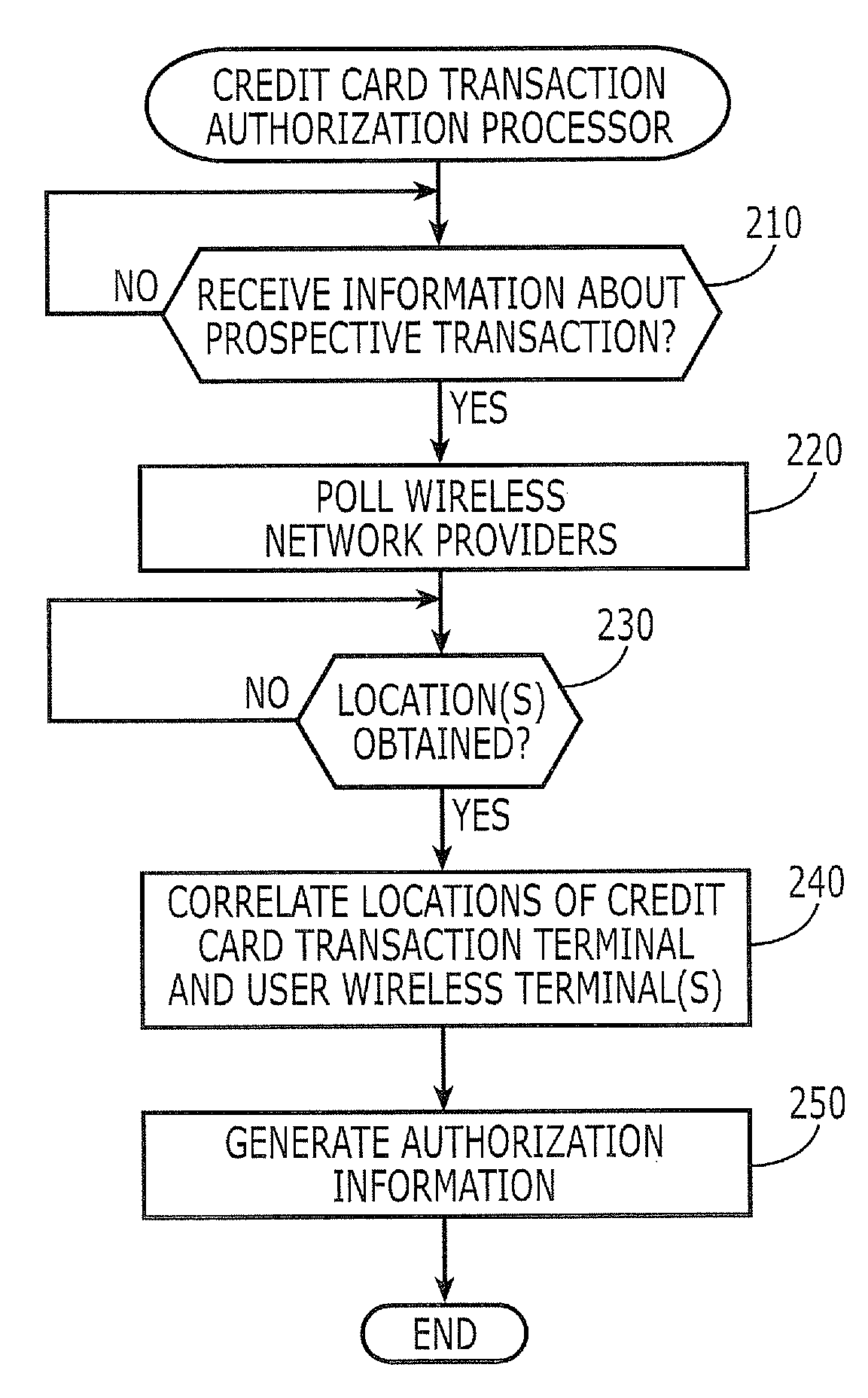

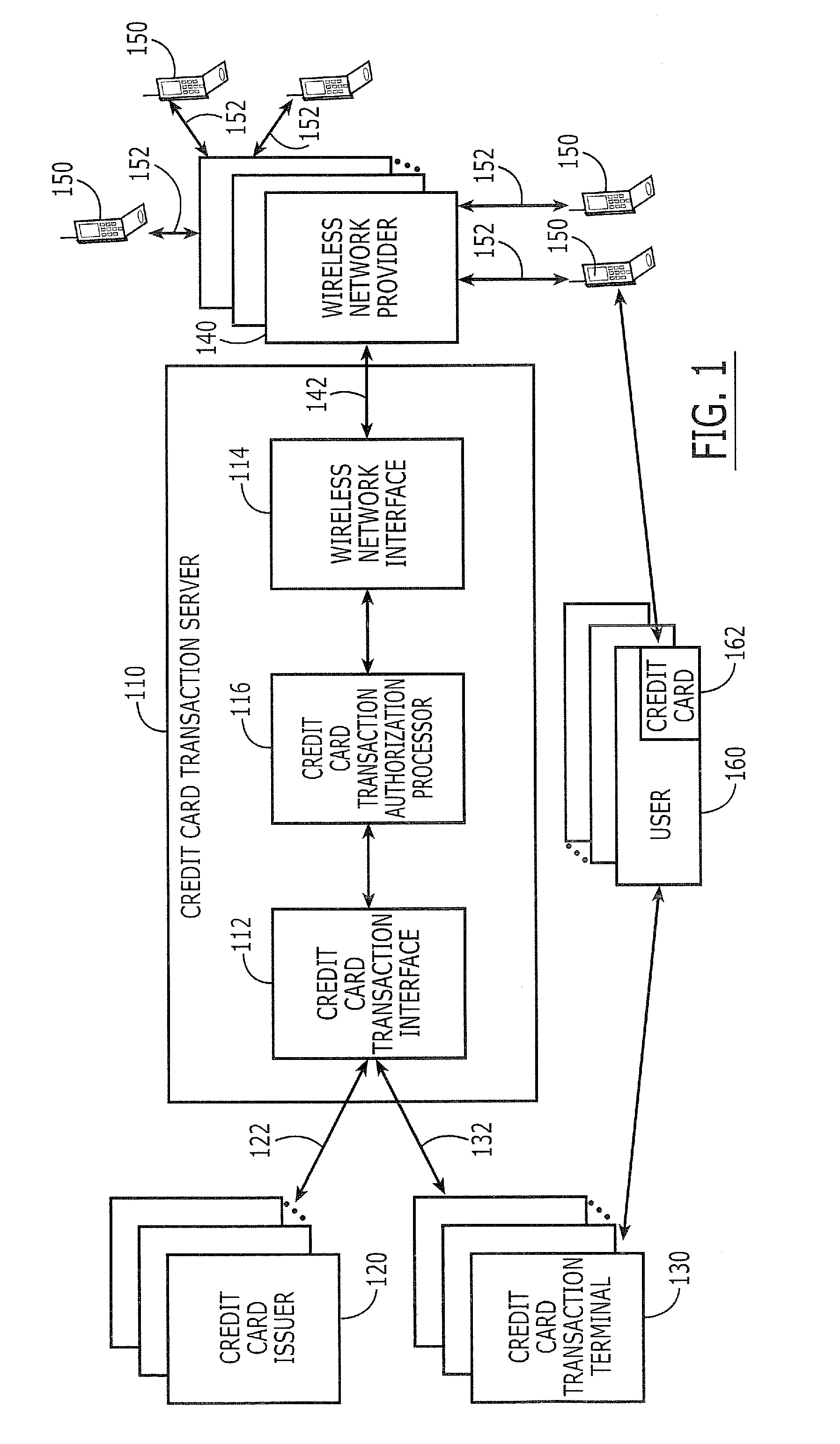

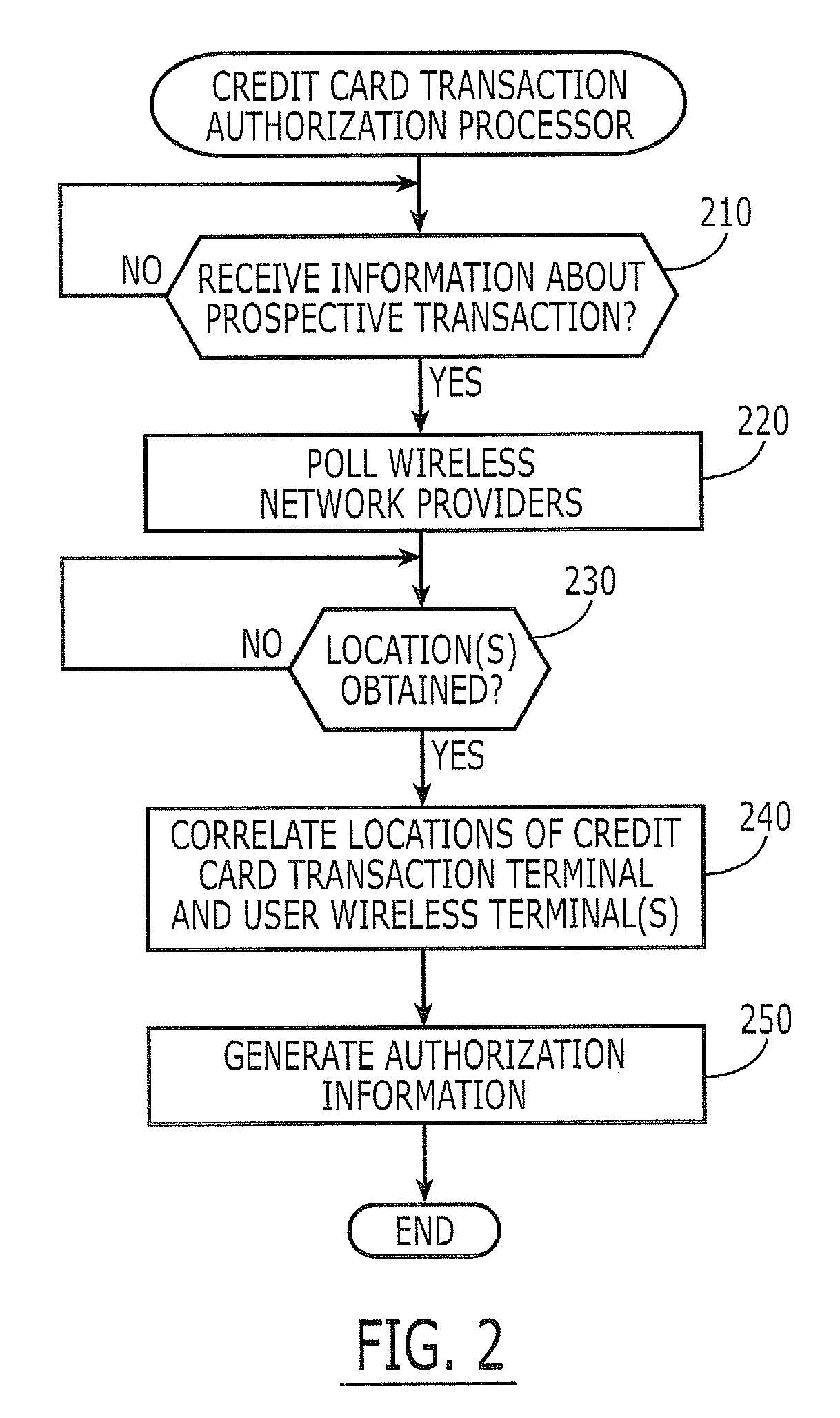

User terminal location based credit card authorization servers, systems, methods and computer program products

Credit card transaction servers, systems, methods and computer program products receive information concerning a prospective credit card transaction with one of multiple credit card issuers and obtain location information from multiple wireless network providers for wireless terminal(s) that are associated with a user of the credit card for the prospective credit card transaction. The locations of the credit card transaction terminal(s) and the locations of the wireless terminal(s) are correlated, and authorization information for the prospective credit card transaction is generated based upon this location correlation.

Owner:AT&T INTPROP I L P

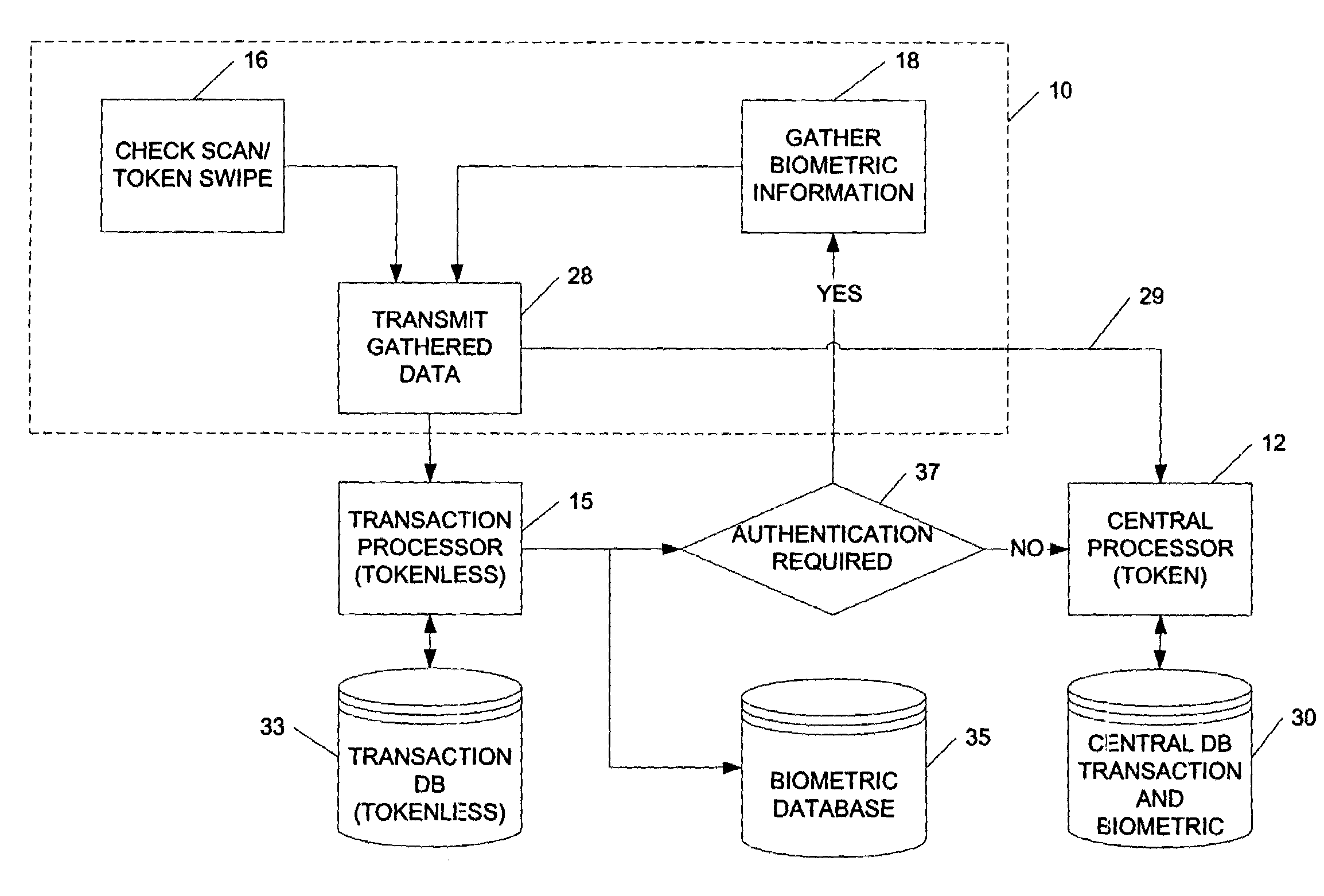

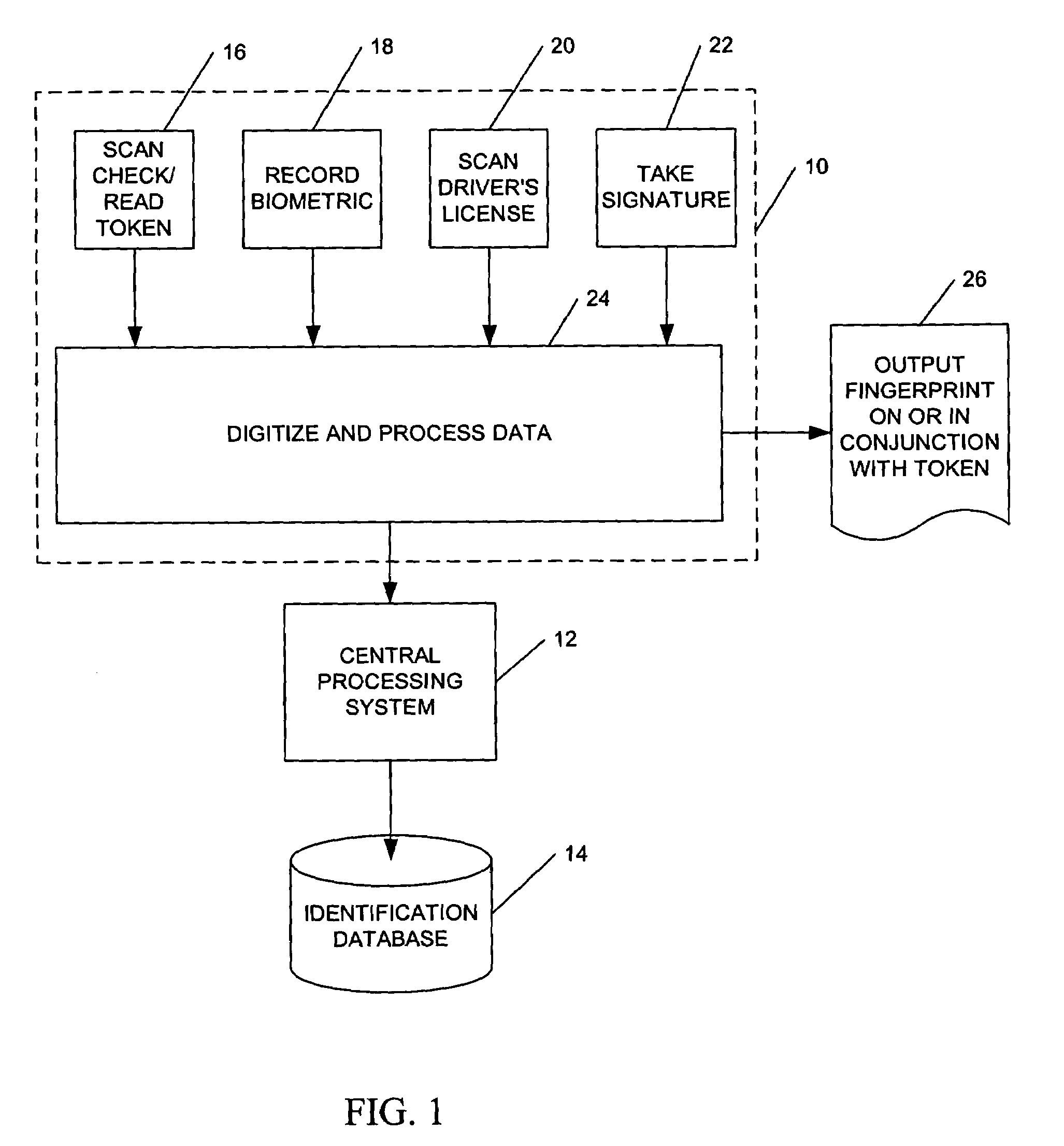

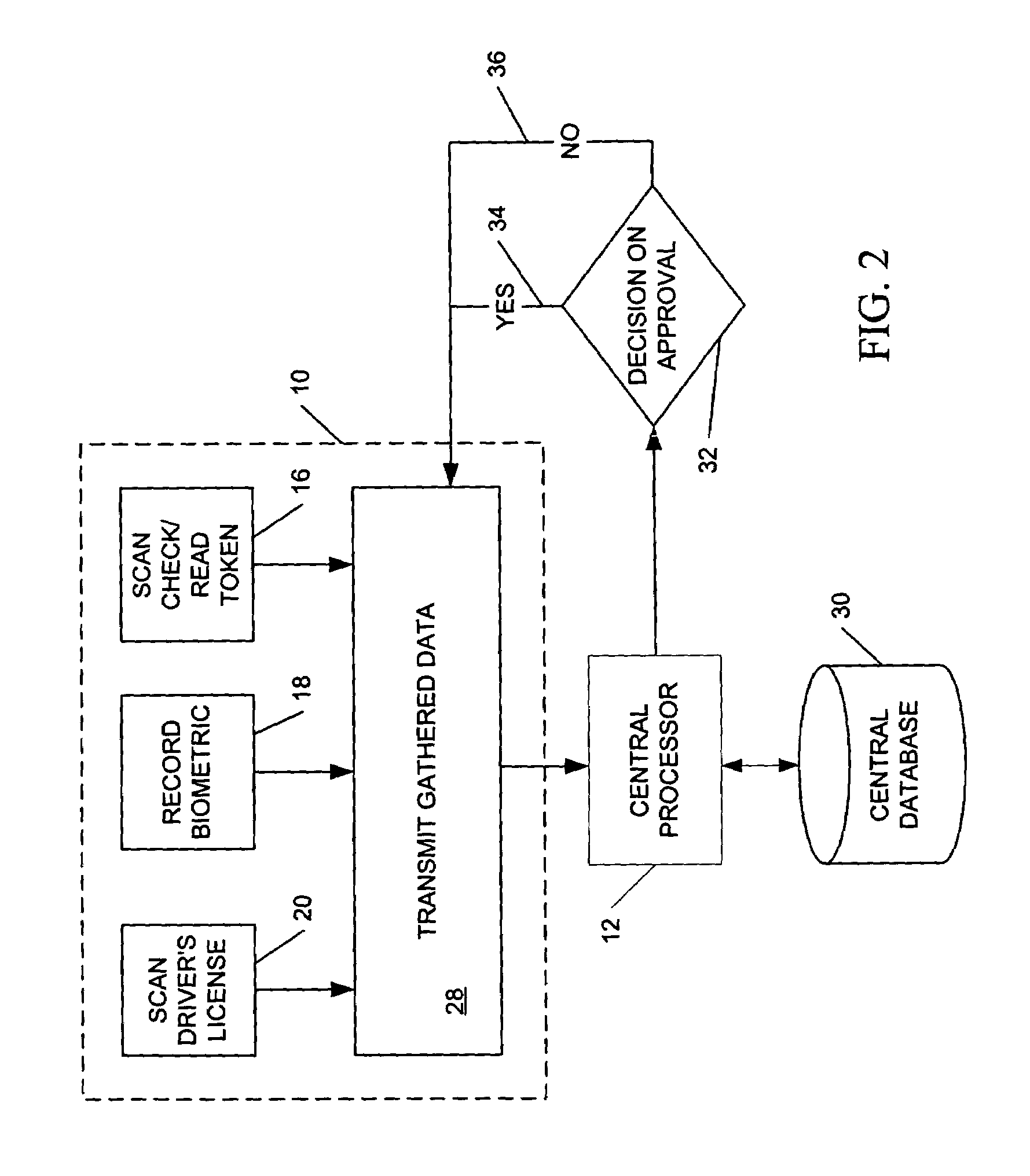

Electronic transaction verification system

InactiveUS7349557B2Inhibitory activityIndustrial applicabilityElectric signal transmission systemsDigital data processing detailsPaymentBiometric data

An electronic transaction verification system for use at a location where a transaction token is presented for payment. The electronic transaction verification system digitizes various indicia of the token, and transmits the transaction information data to a central processing system. The central processing system compares the transaction data with an existing database of information to determine if the customer at the point of the transaction is authorized to use the account. The electronic verification system includes a biometric data device for recording and / or transmitting biometric data taken at the transaction location. The electronic transaction verification system can be used in conjunction with a tokenless transaction processing system to determine if the token presented for payment is associated with an account established for an authorized user that has registered with the tokenless transaction processing system.

Owner:BIOMETRIC PAYMENT SOLUTIONS

Popular searches

Wireless commuication services Securing communication Coin/currency accepting devices Buying/selling/leasing transactions Special data processing applications Coded identity card or credit card actuation Verifying markings correctness Transmission Computer security arrangements Navigation instruments

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com