Patents

Literature

7619results about "Coin/currency accepting devices" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

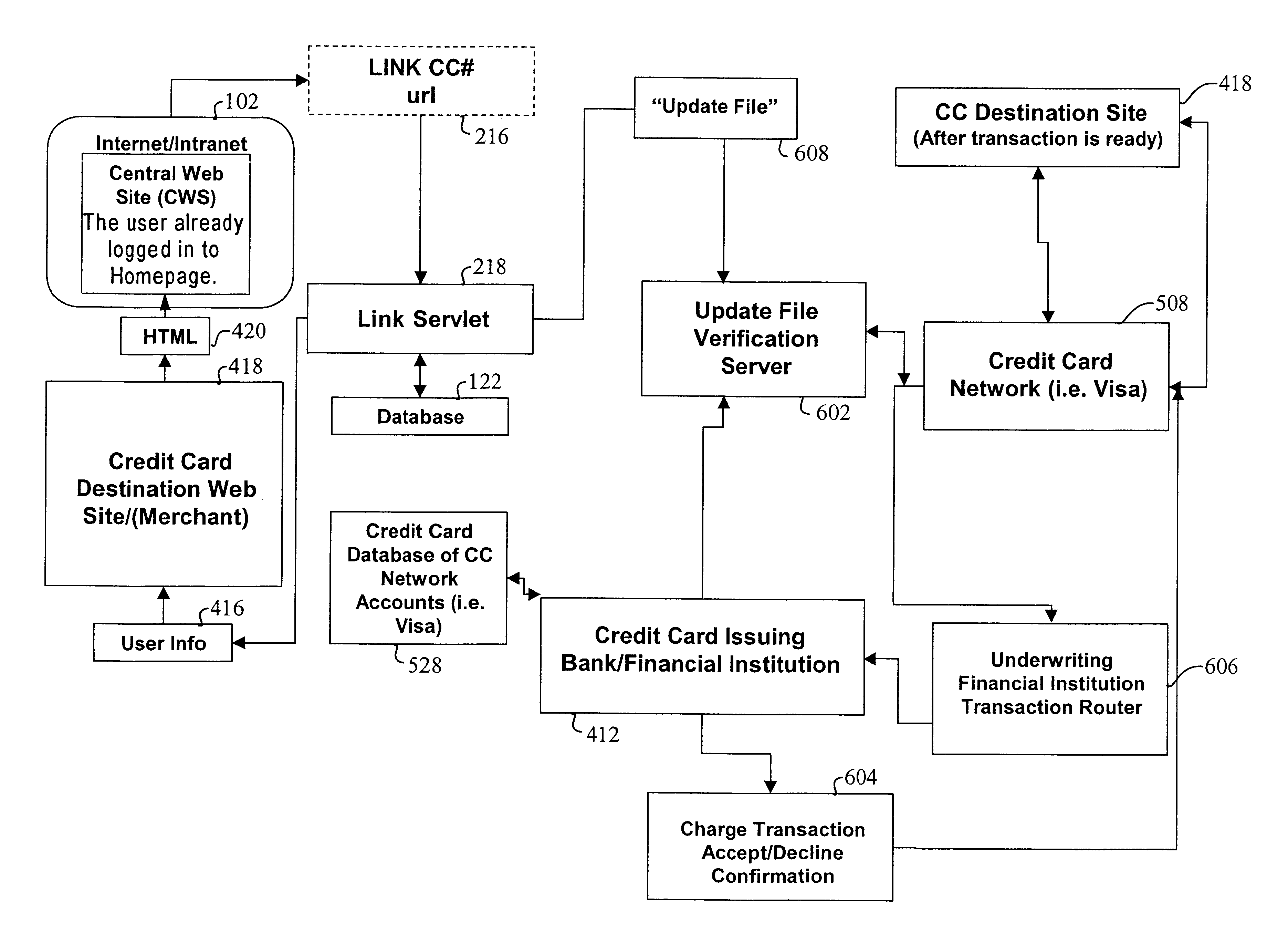

Method and apparatus for funds and credit line transfers

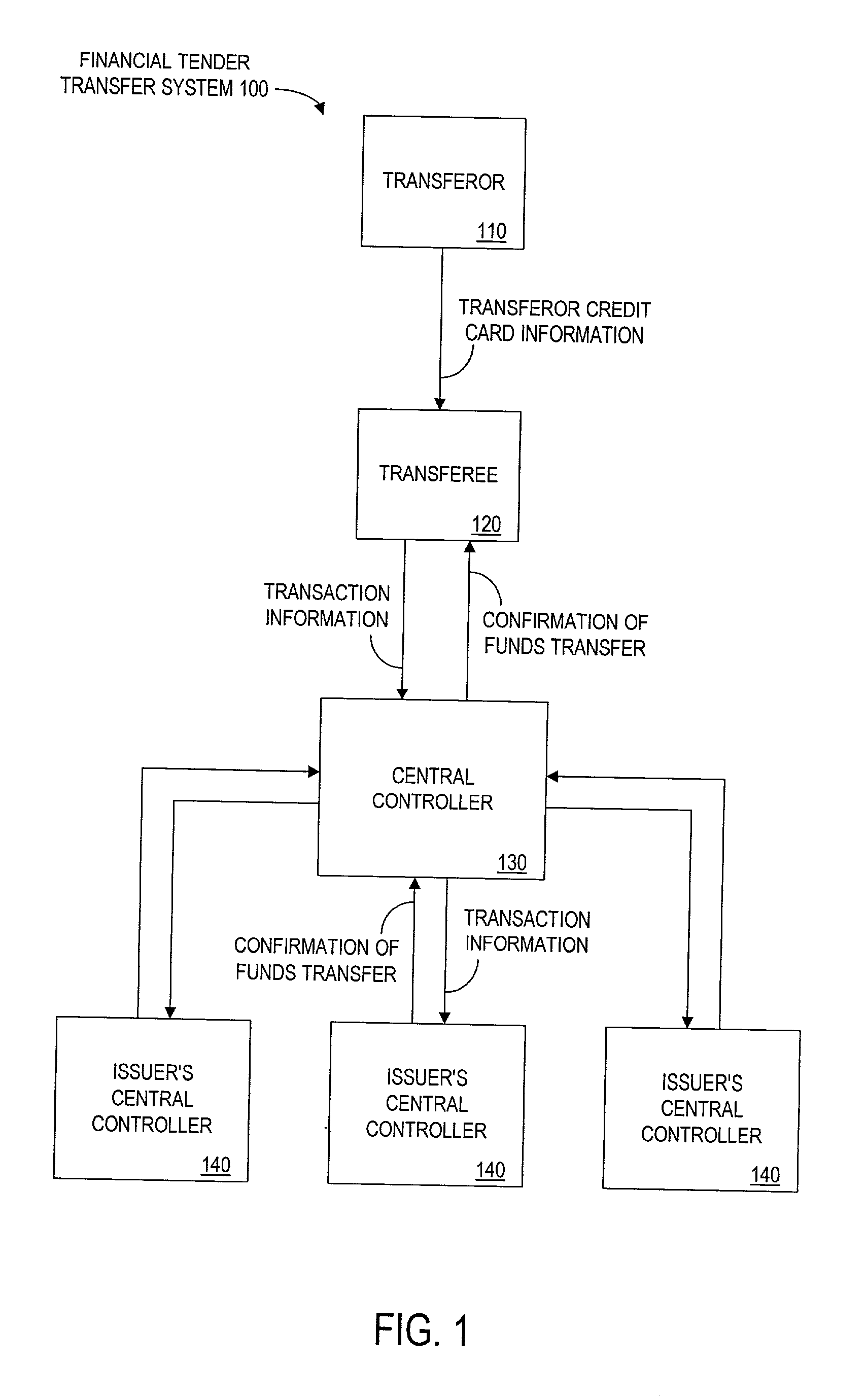

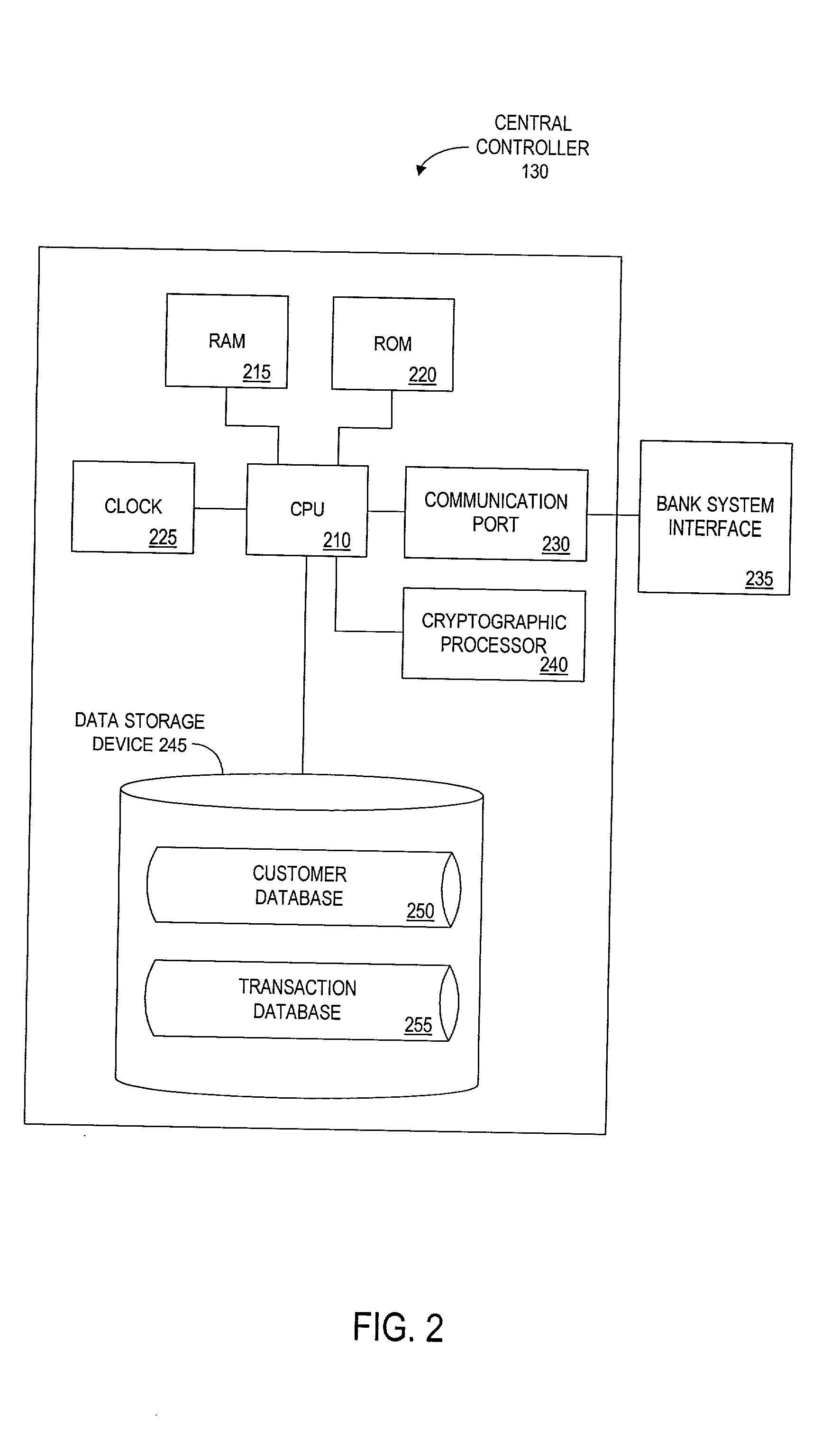

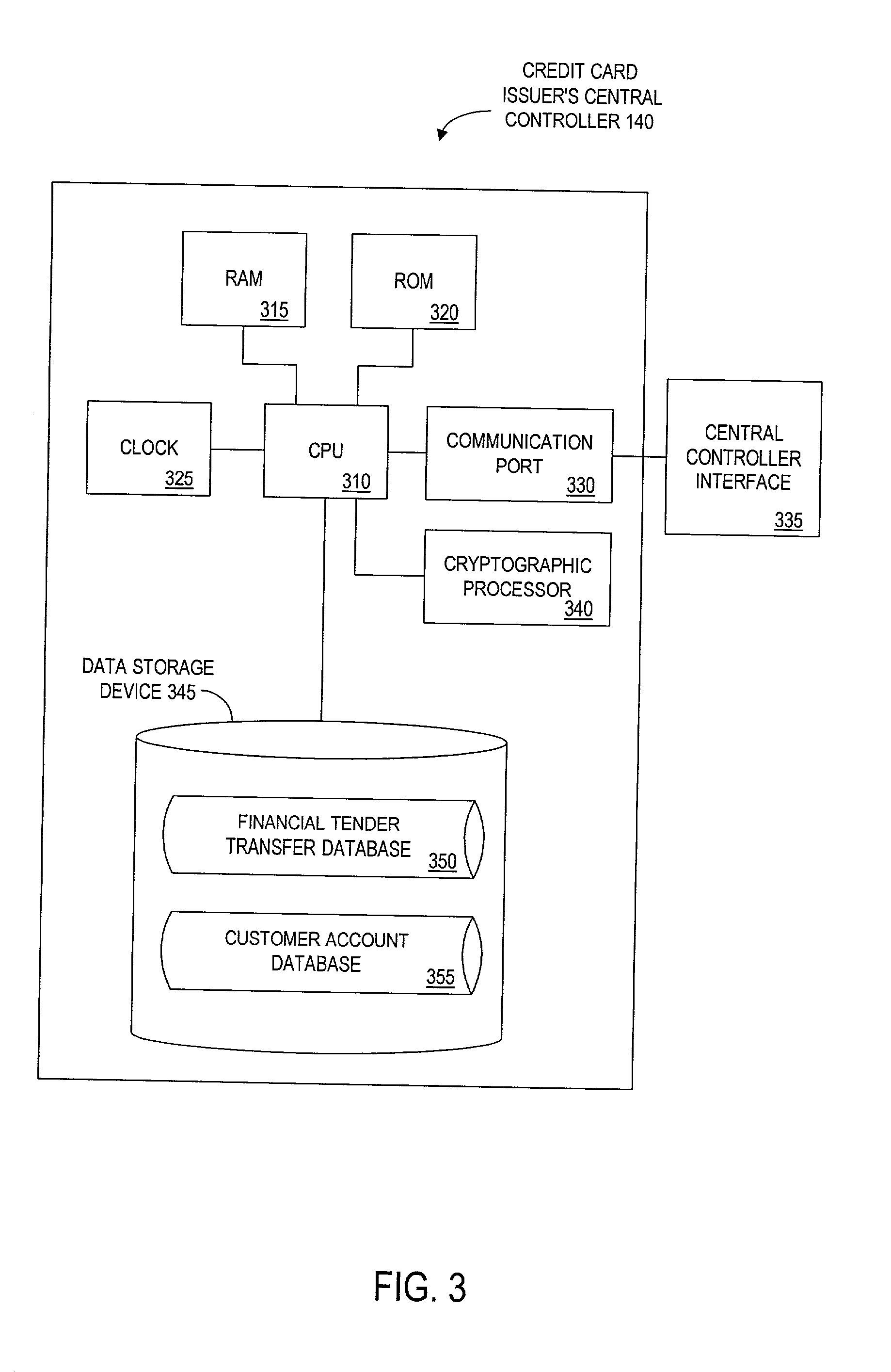

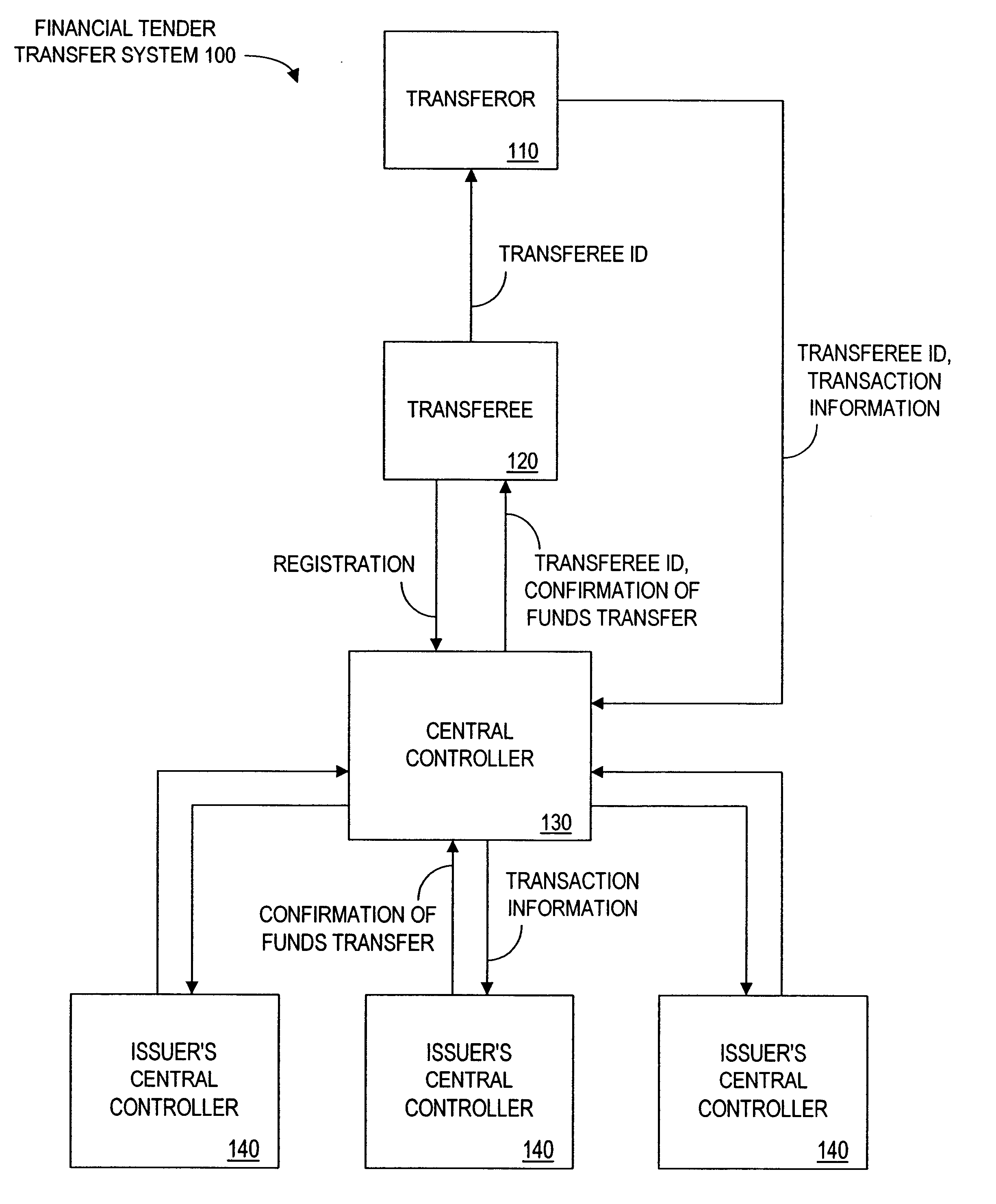

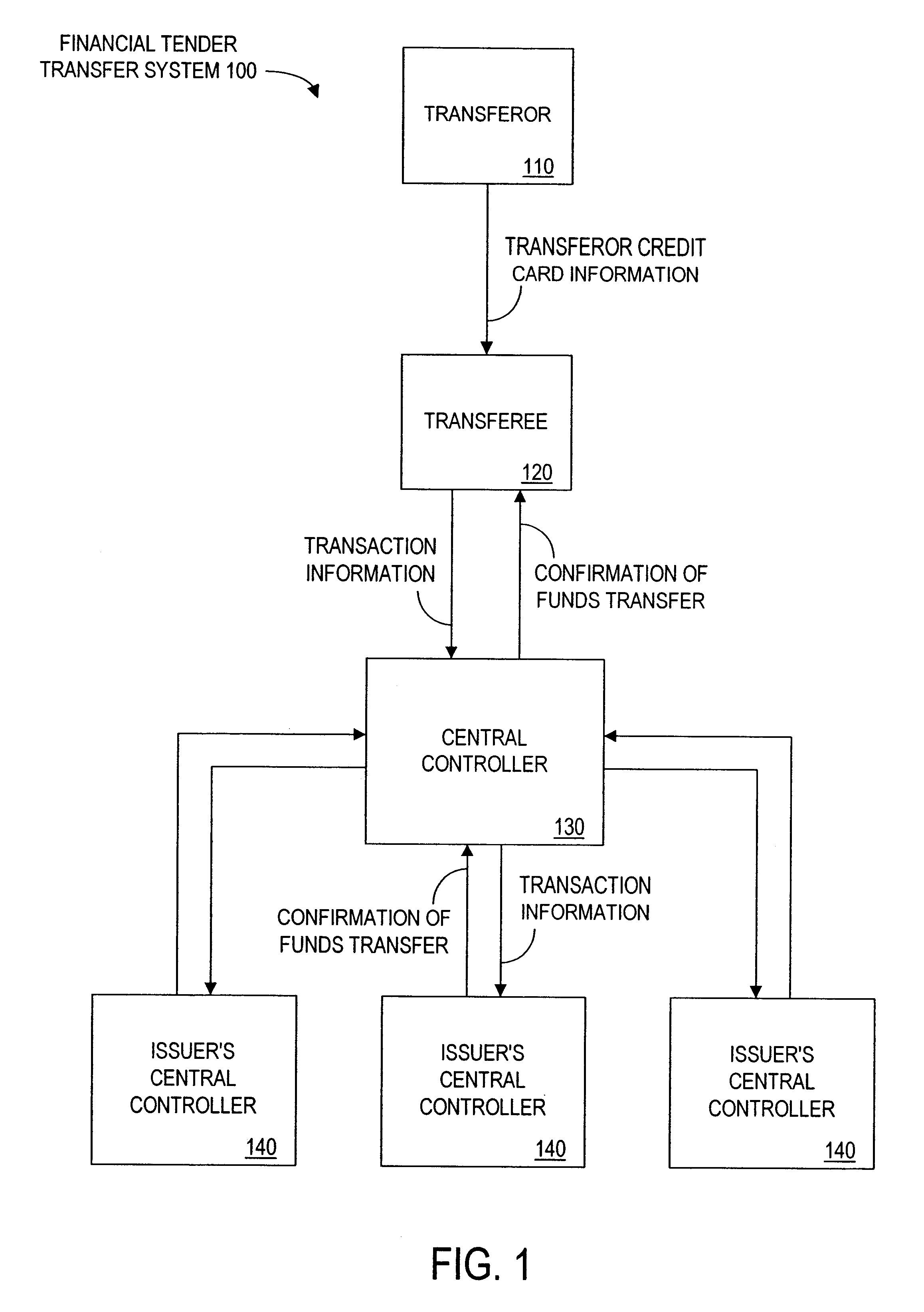

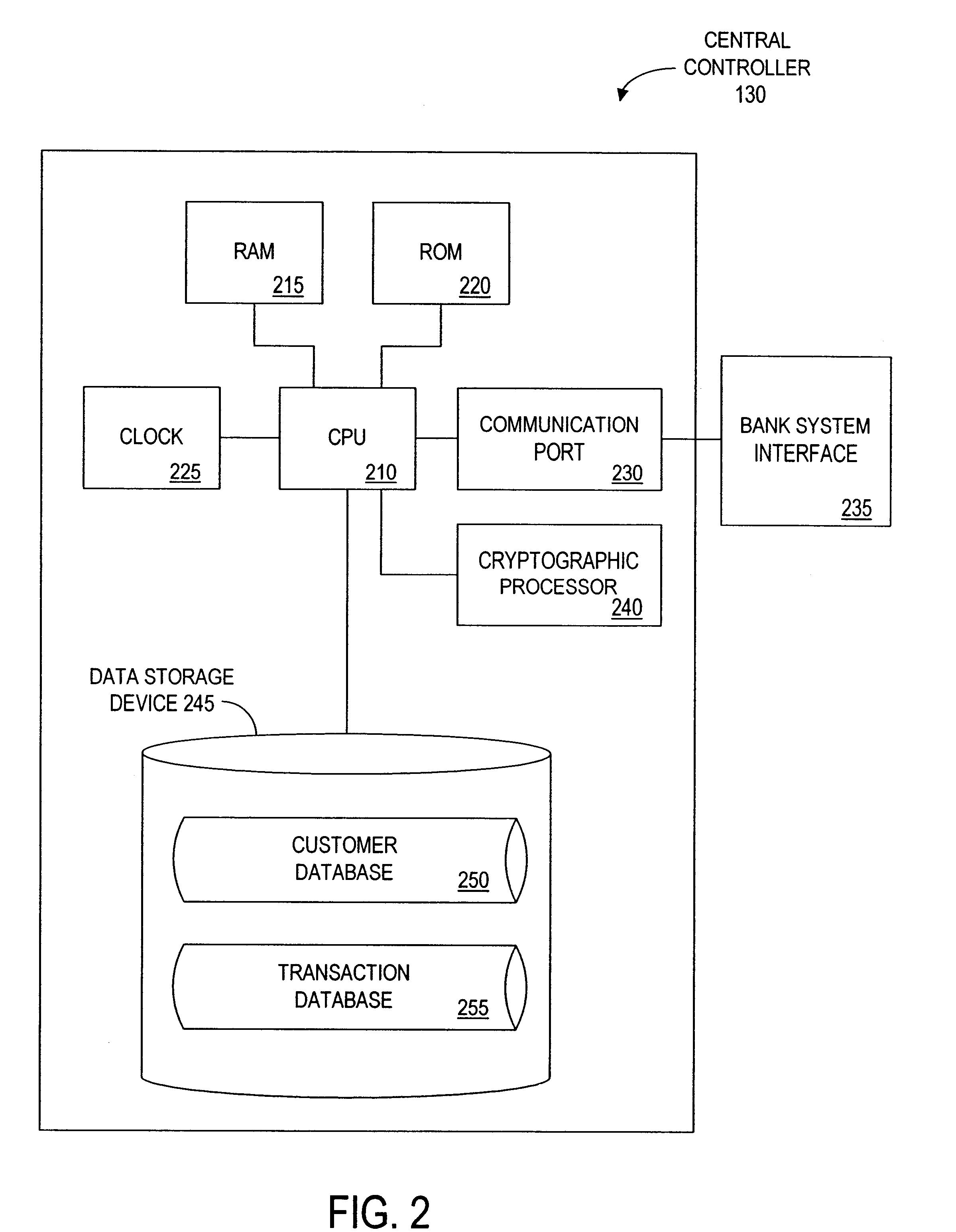

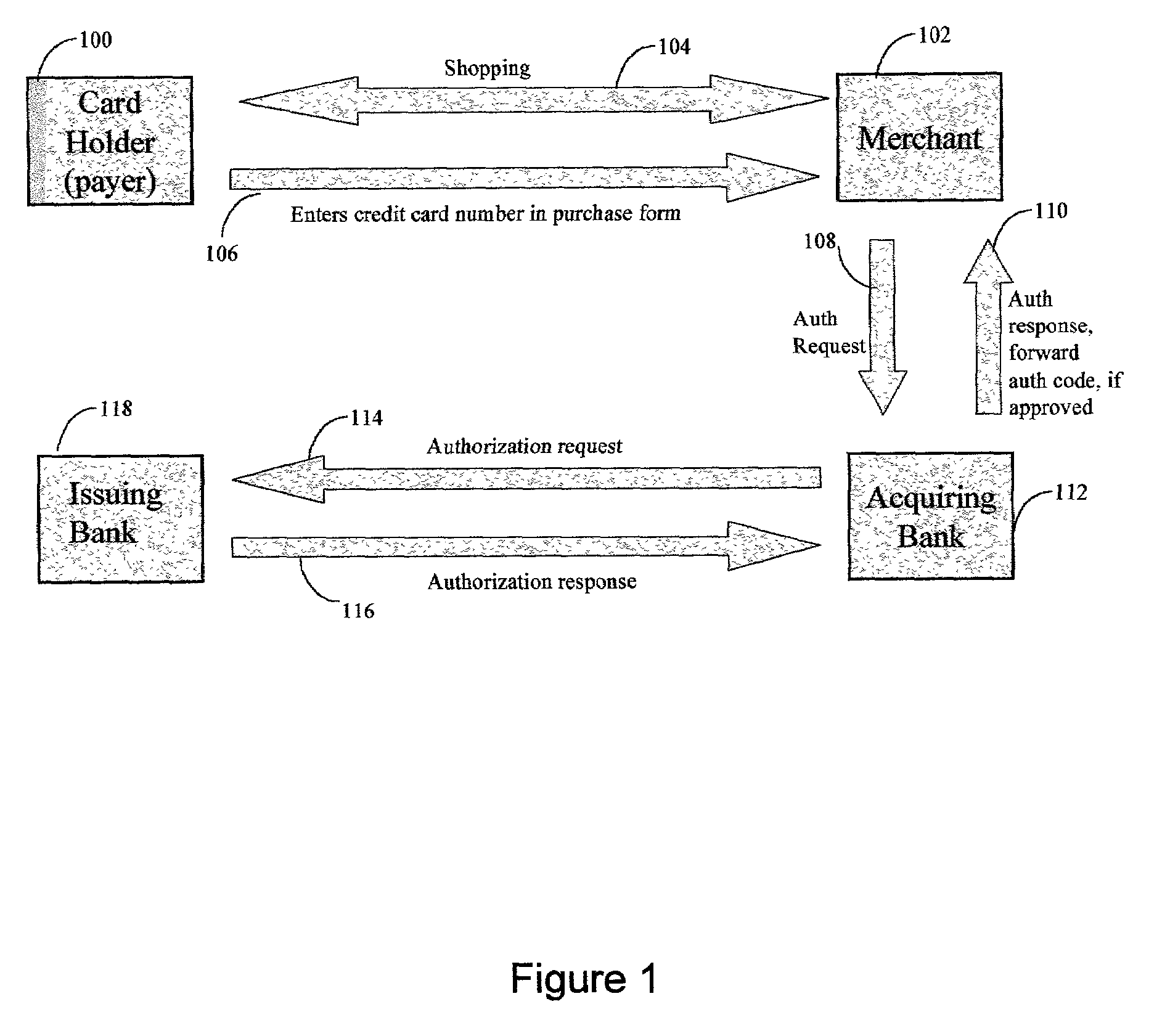

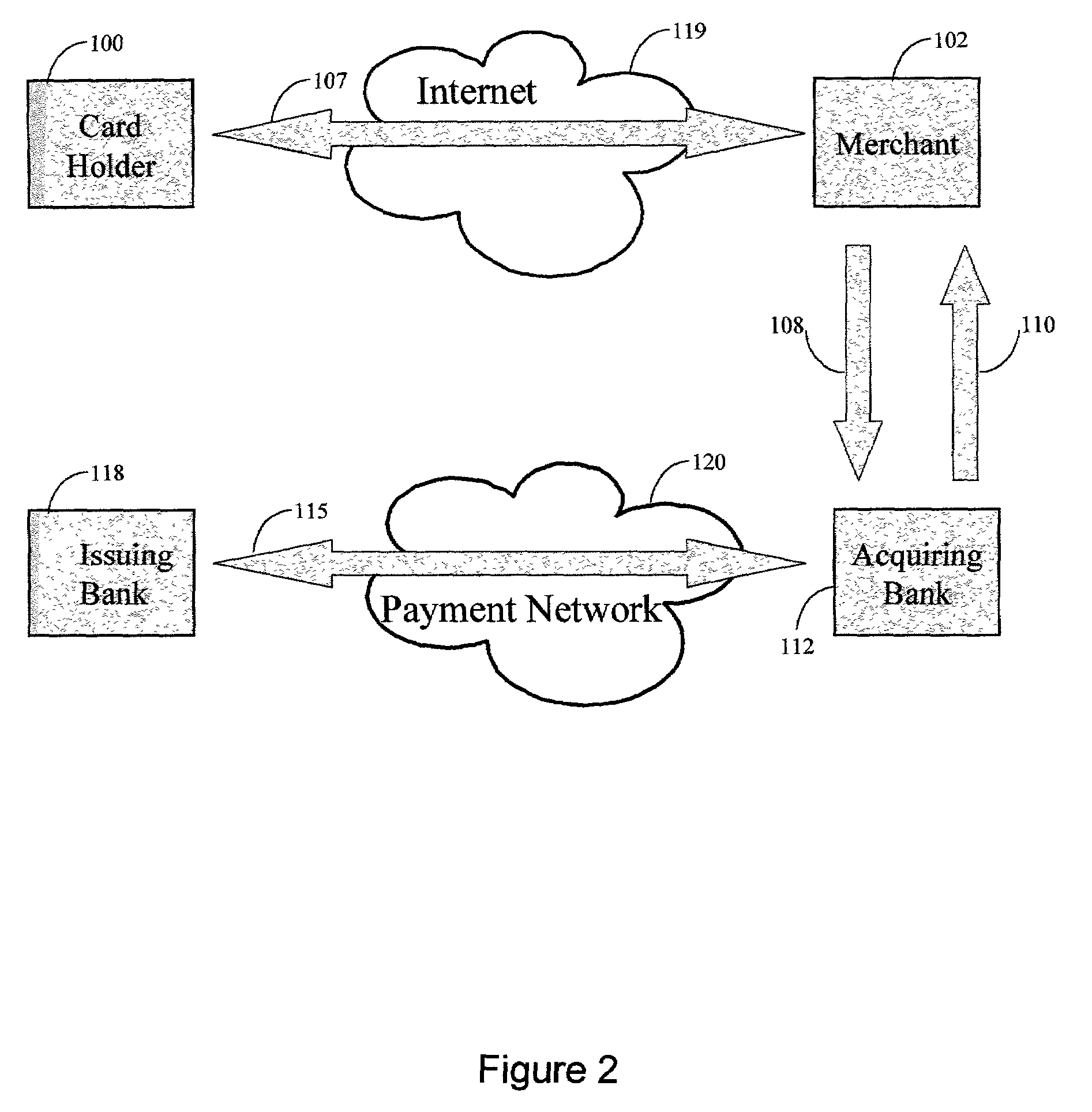

A financial tender transfer system allows a transferor to transfer credit or make payment to a transferee by debiting the credit card of the transferor and crediting the credit card of the transferee. The financial tender transfer system gives the transferee immediate access to the transferred money and ensures the transferor's credit card is valid. Neither party needs to give their credit card number to the other, so security is preserved. Any amount of value up to the full credit line of the transferor can be transferred to the transferee.

Owner:PAYPAL INC

Method and apparatus for funds and credit line transfers

A financial tender transfer system allows a transferor to transfer credit or make payment to a transferee by debiting the credit card of the transferor and crediting the credit card of the transferee. The financial tender transfer system gives the transferee immediate access to the transferred money and ensures the transferor's credit card is valid. Neither party needs to give their credit card number to the other, so security is preserved. Any amount of value up to the full credit line of the transferor can be transferred to the transferee.

Owner:PAYPAL INC

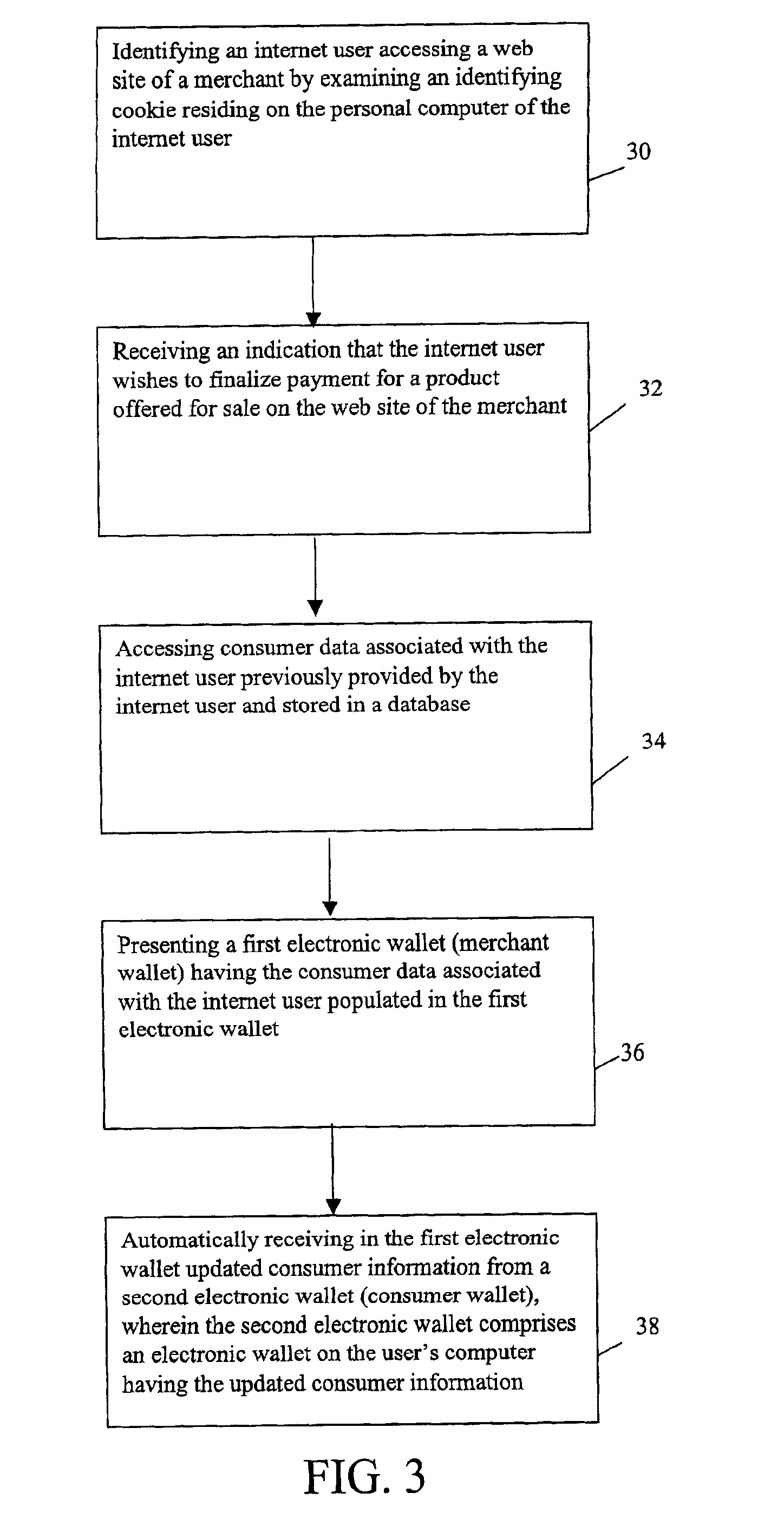

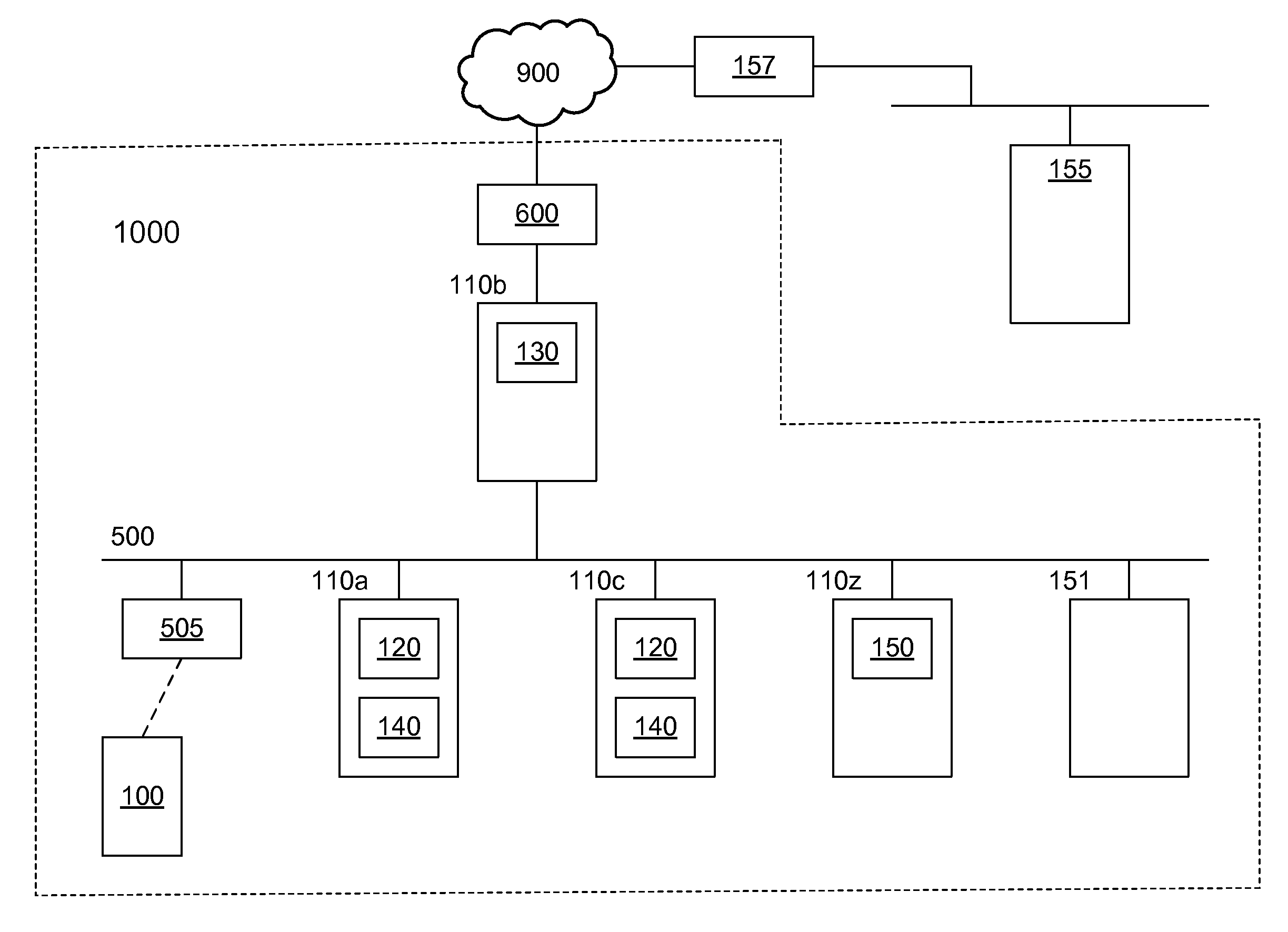

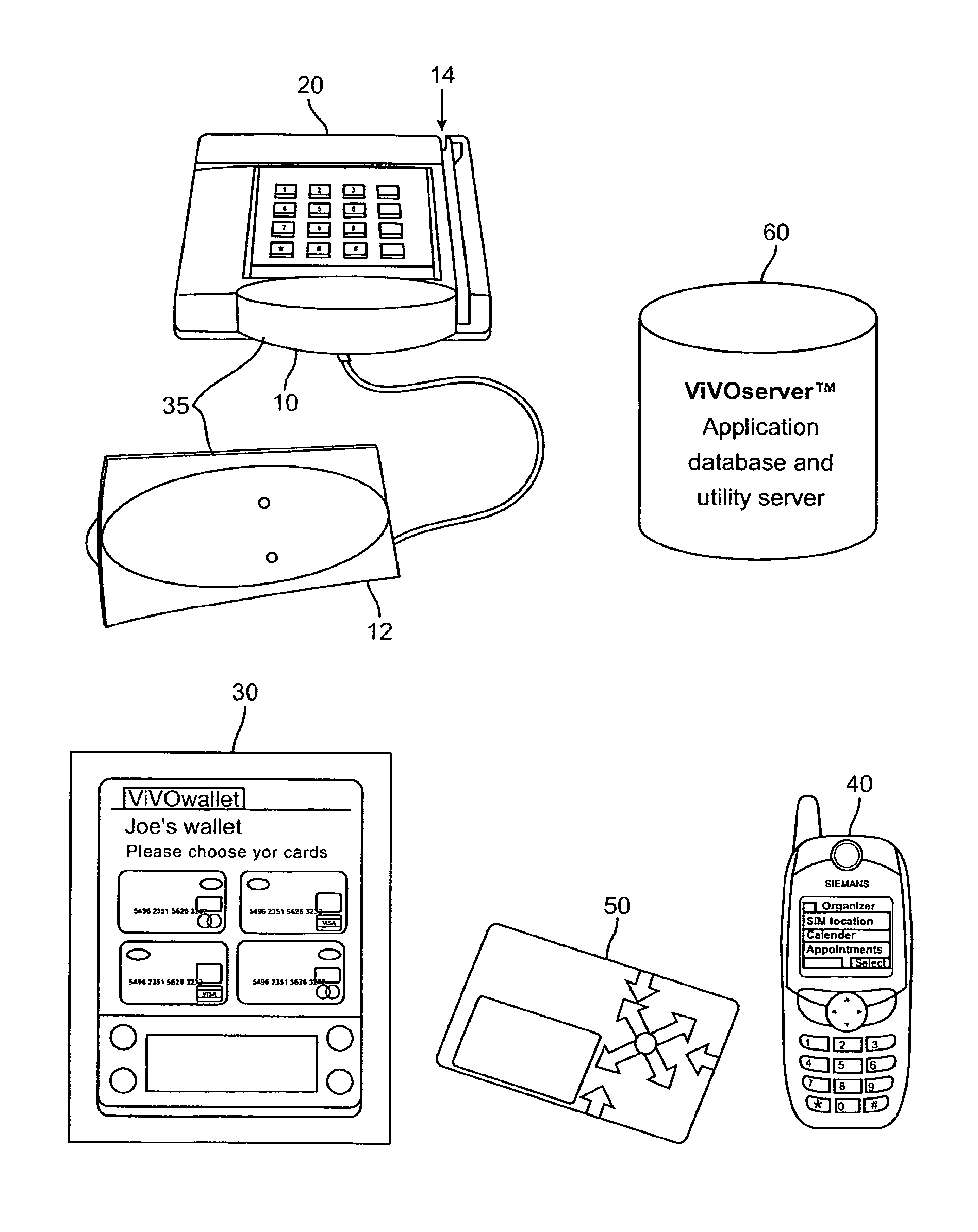

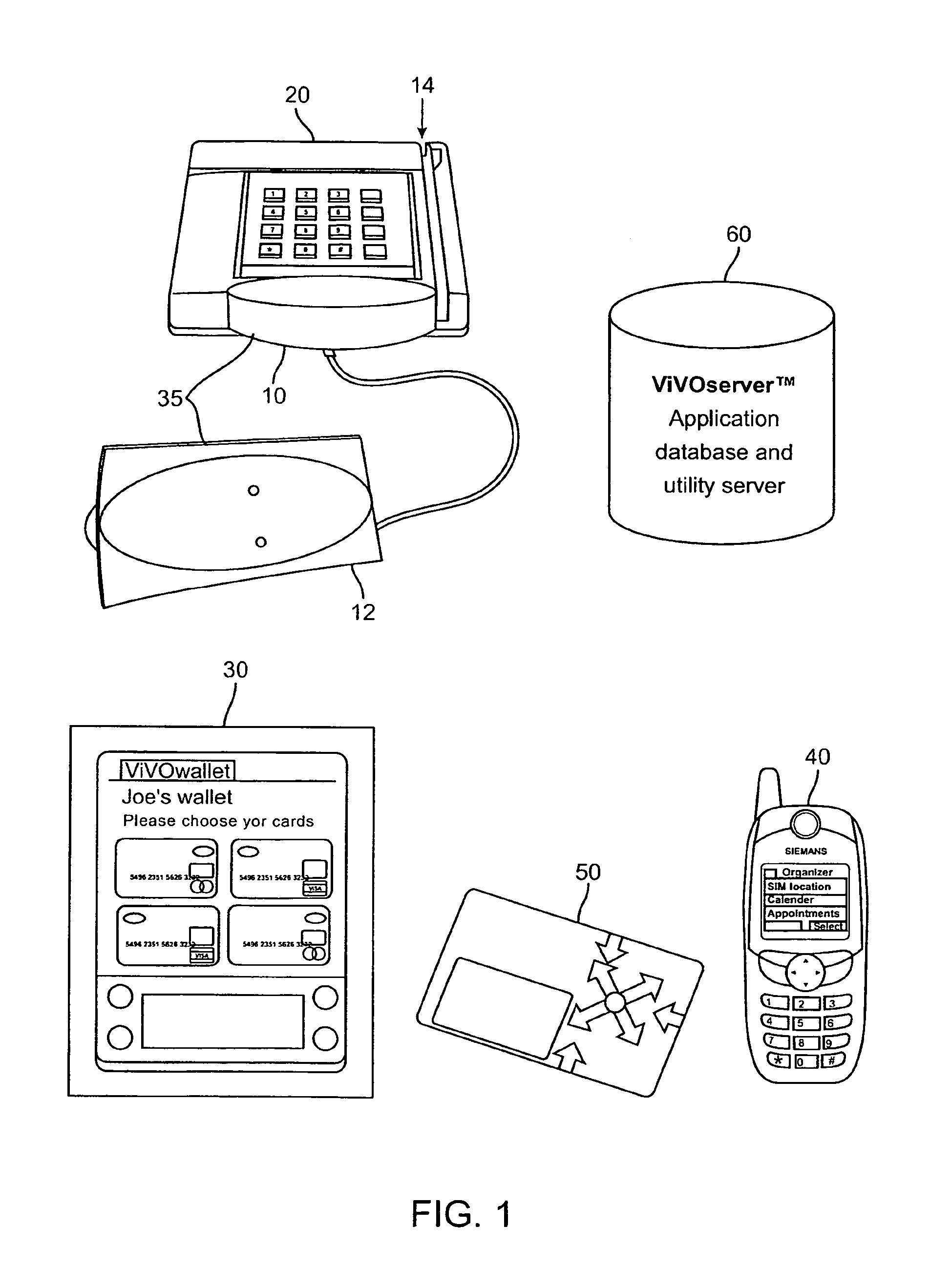

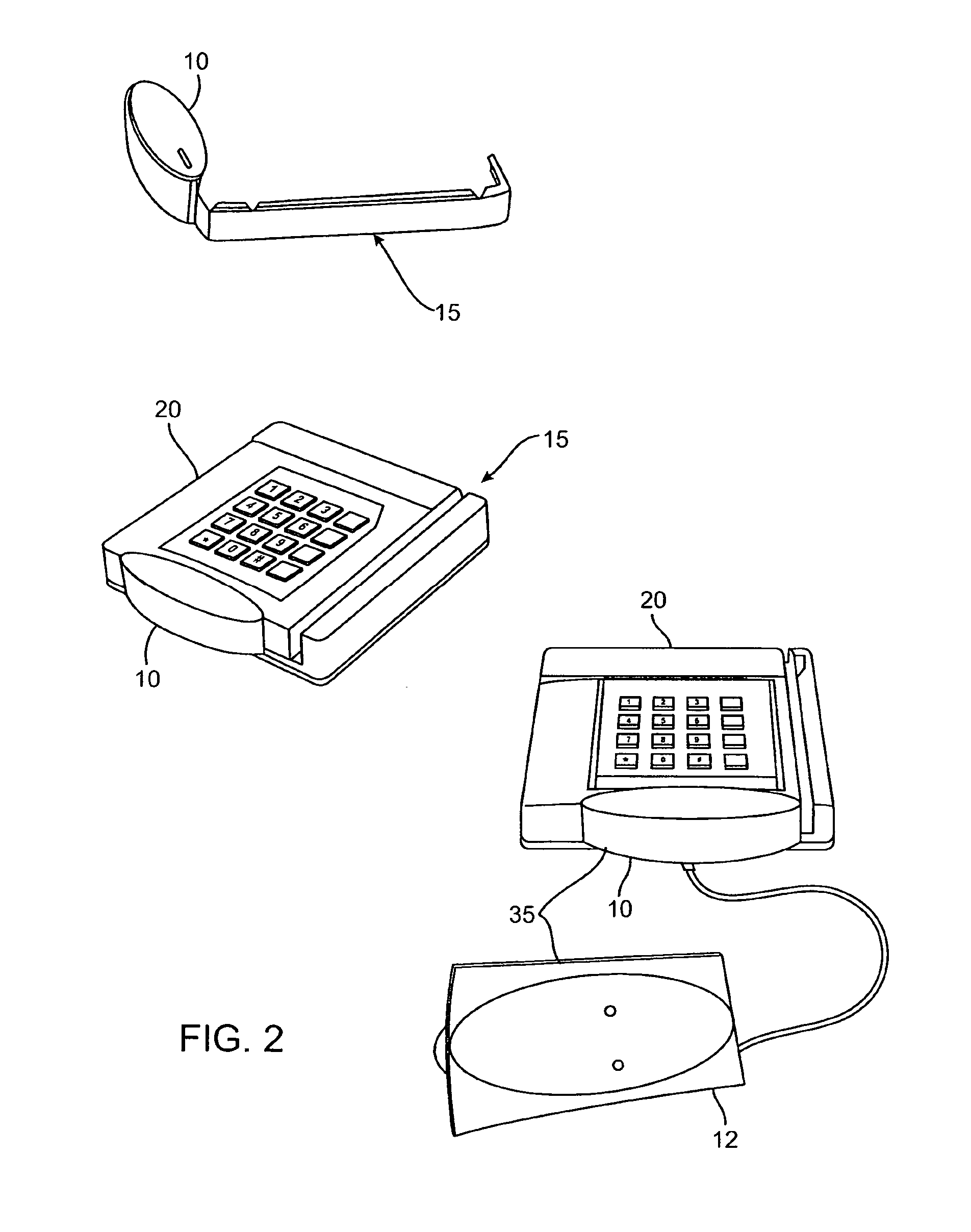

System and method for use of distributed electronic wallets

InactiveUS6873974B1Avoid burdenImprove efficiencyComplete banking machinesFinanceMerchant servicesCredit card

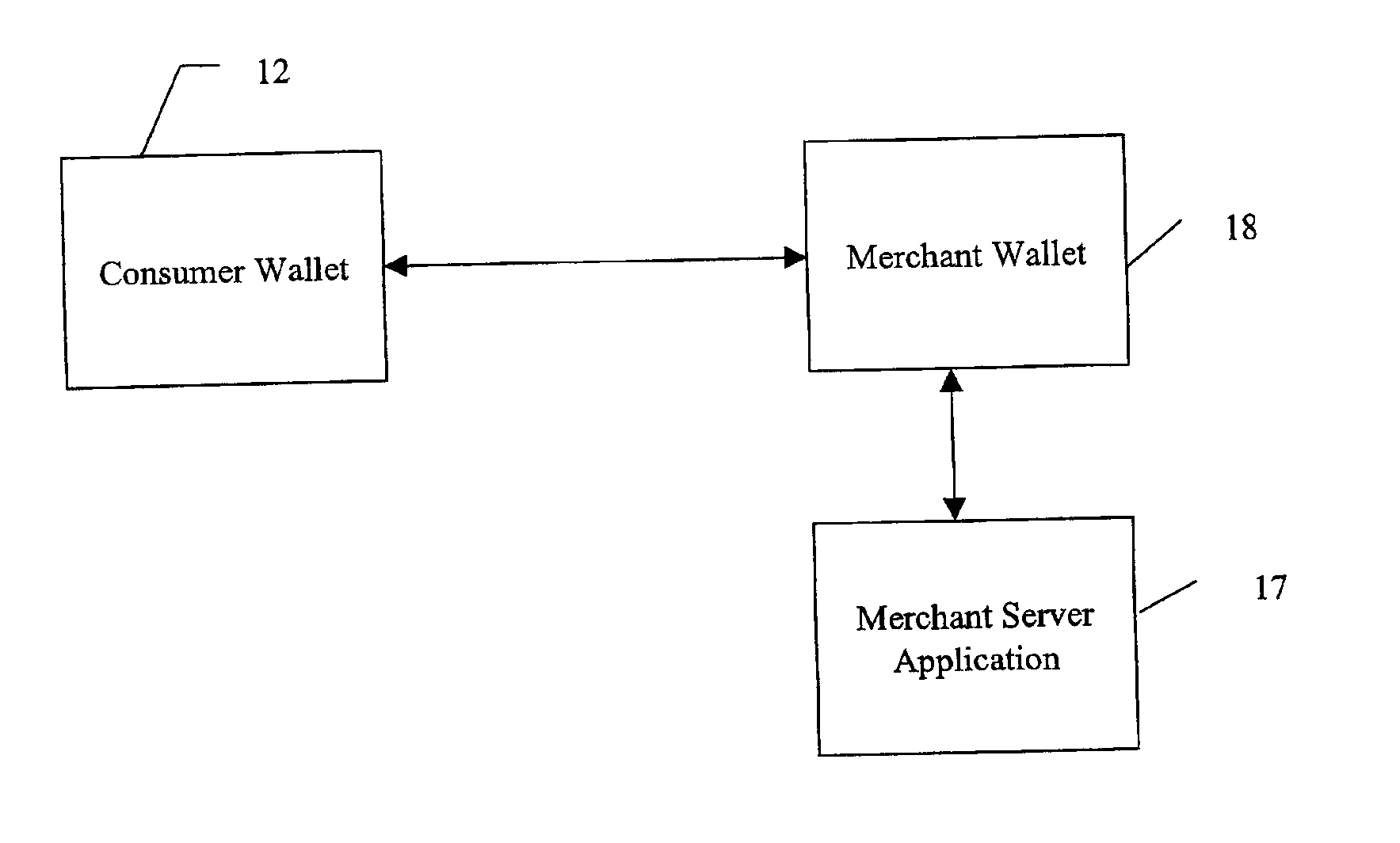

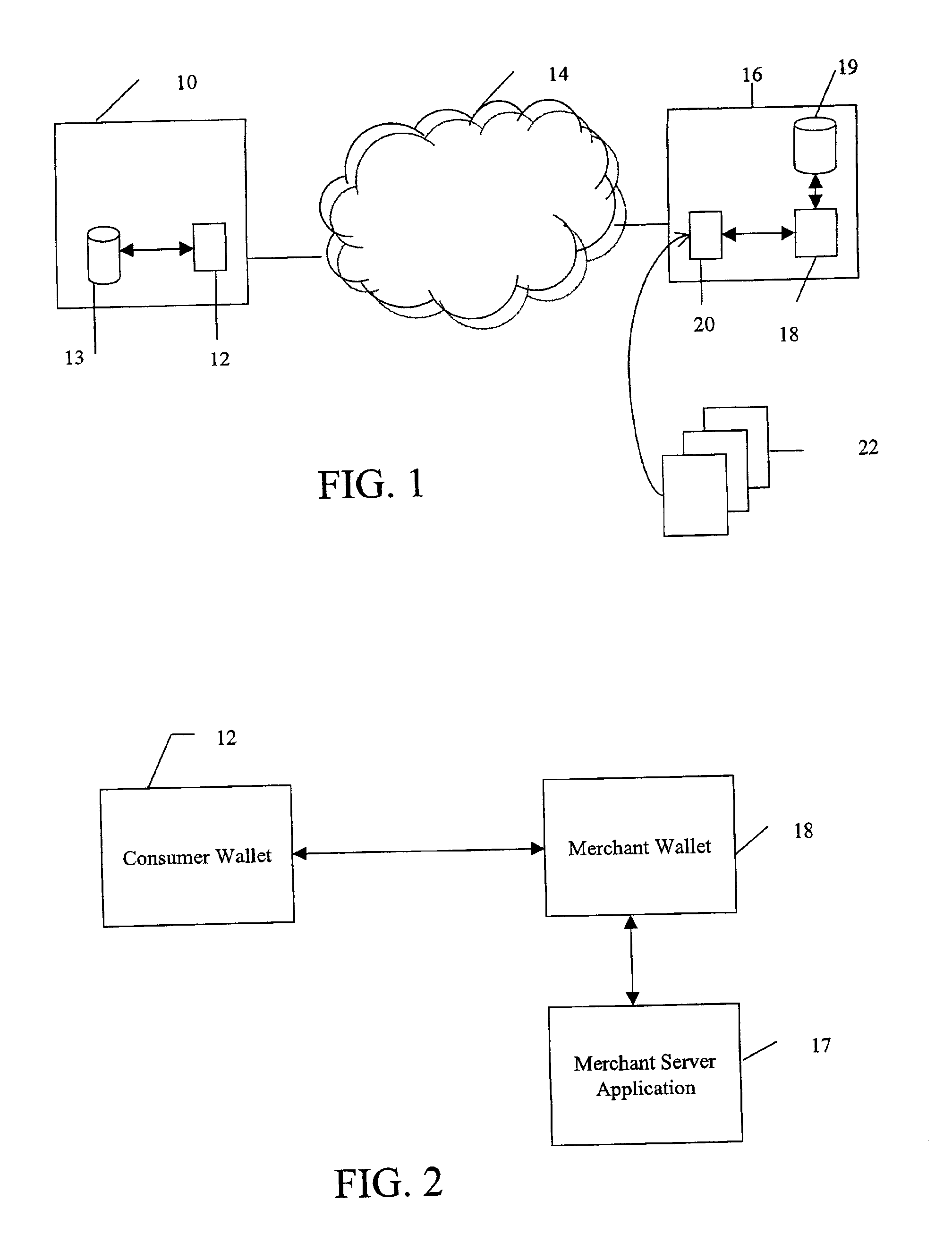

Methods and systems whereby two electronic wallets communicate and exchange information. In one such system, a consumer's personal electronic wallet communicates with the exclusive or preferred wallet of a web merchant. In one such system, an internet consumer registers with a web merchant's exclusive or preferred electronic wallet (“merchant wallet”) and provides consumer information (e.g., credit card number, mailing address, and other information) to the merchant wallet, which is stored by the merchant wallet in a database on the merchant server. Such information may be automatically populated by the consumer's personal electronic wallet. The consumer maintains current consumer information in a consumer electronic wallet on the consumer's personal computer. When the consumer visits the merchant site again, and orders goods or services, the merchant's preferred wallet can be automatically updated by the consumer's electronic wallet if any of the data in the merchant's wallet has changed. For example, the consumer wallet examines the information in the merchant wallet to determine if the information in the merchant wallet conforms to the current information in the consumer wallet. If the information does not conform, the consumer wallet communicates the current consumer information to the merchant wallet.

Owner:CITIBANK

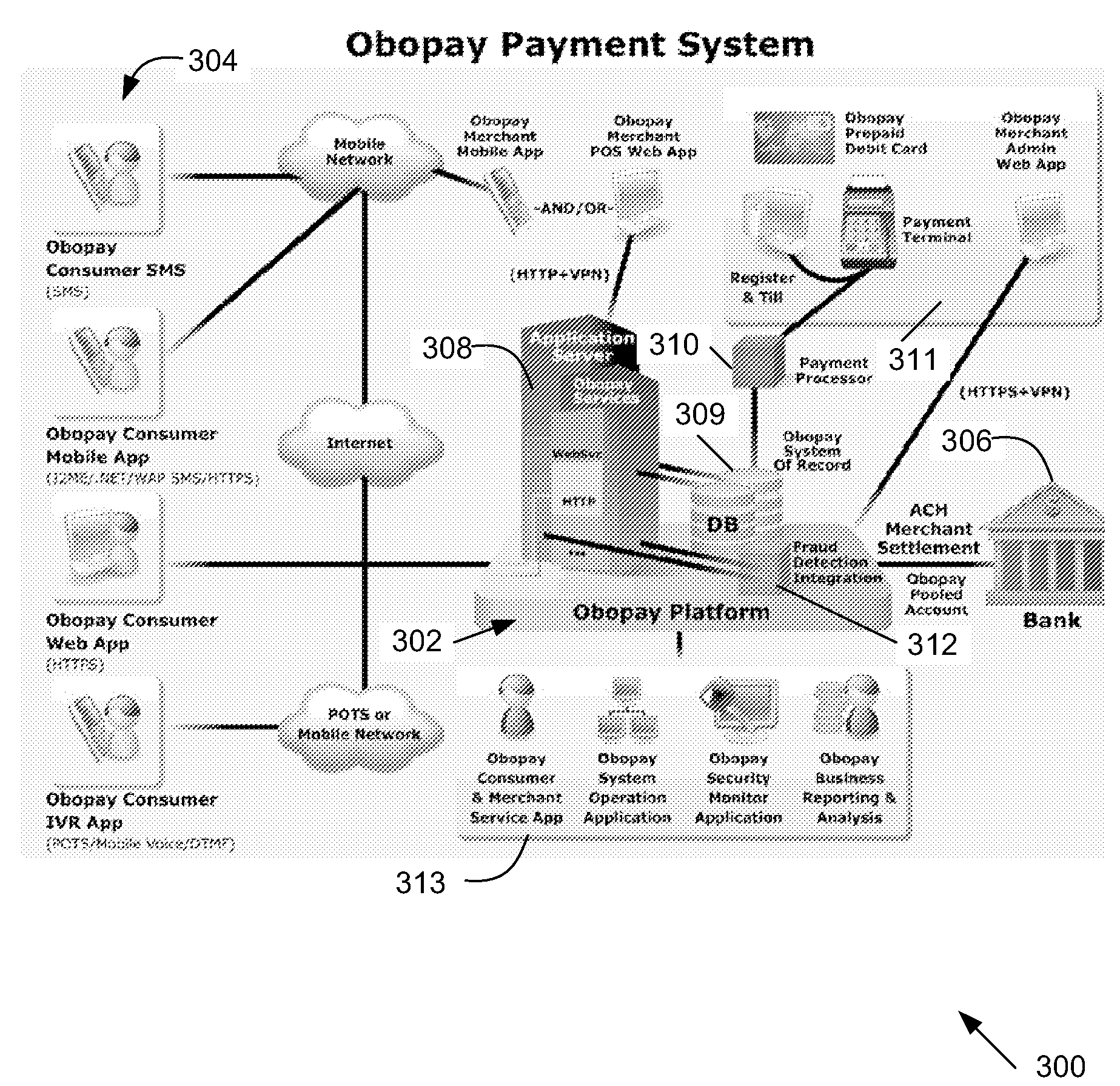

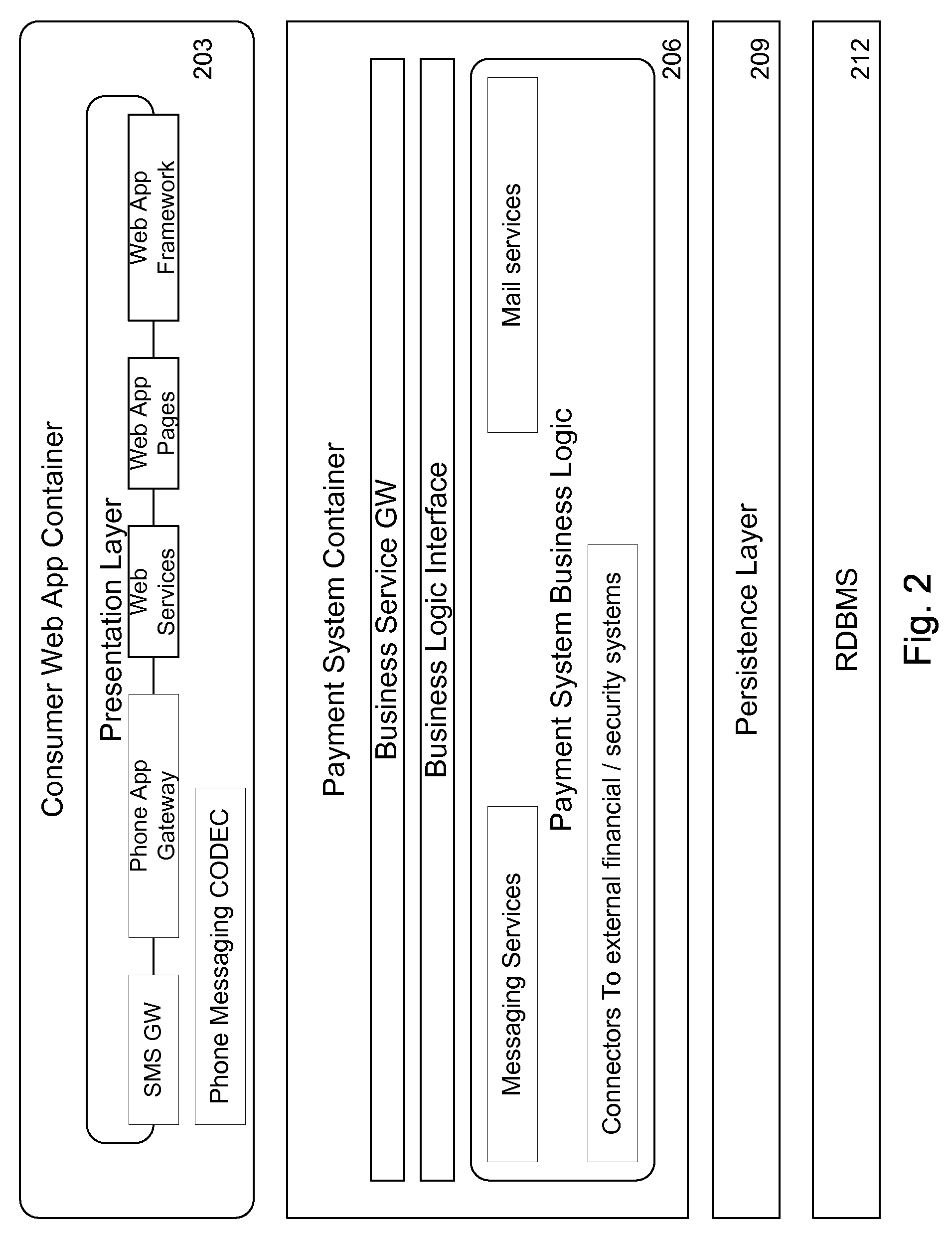

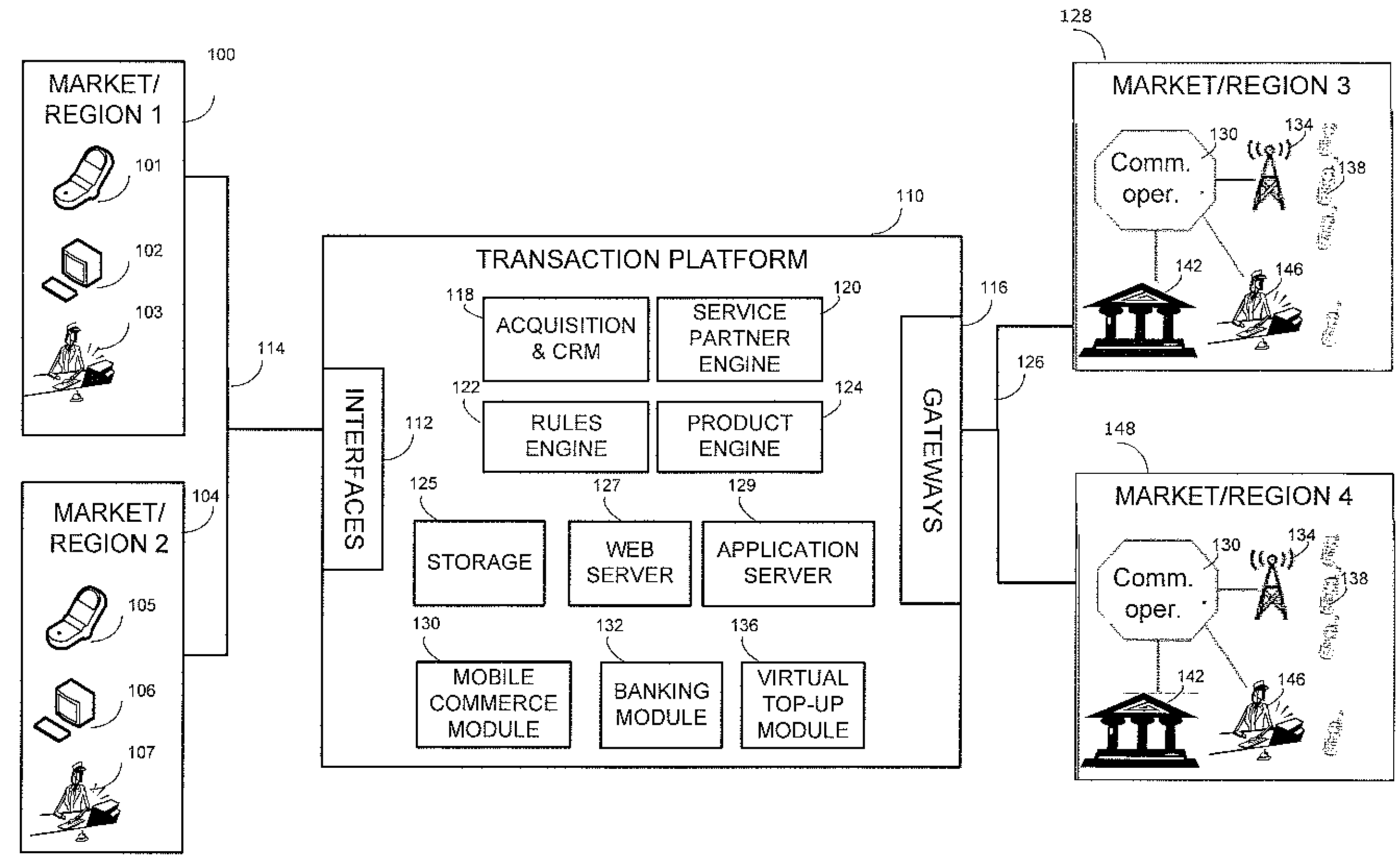

Virtual Pooled Account for Mobile Banking

InactiveUS20090119190A1Reduce settlementReduce operating costsComplete banking machinesFinanceOperational costsSimulation

A virtual pooled account is used in operating a system having multiple financial partners. In a specific implementation, the system is a mobile banking system. Instead of maintaining separate general ledgers for each financial institution, the system will keep one general virtual pooled account. This will reduce the settlement and operational costs of the system. The owner of the virtual pooled account will receive the float on the virtual pooled account, and this float will be distributed to the multiple financial partners according to a formula.

Owner:OBOPAY MOBILE TECH INDIA PTE LTD

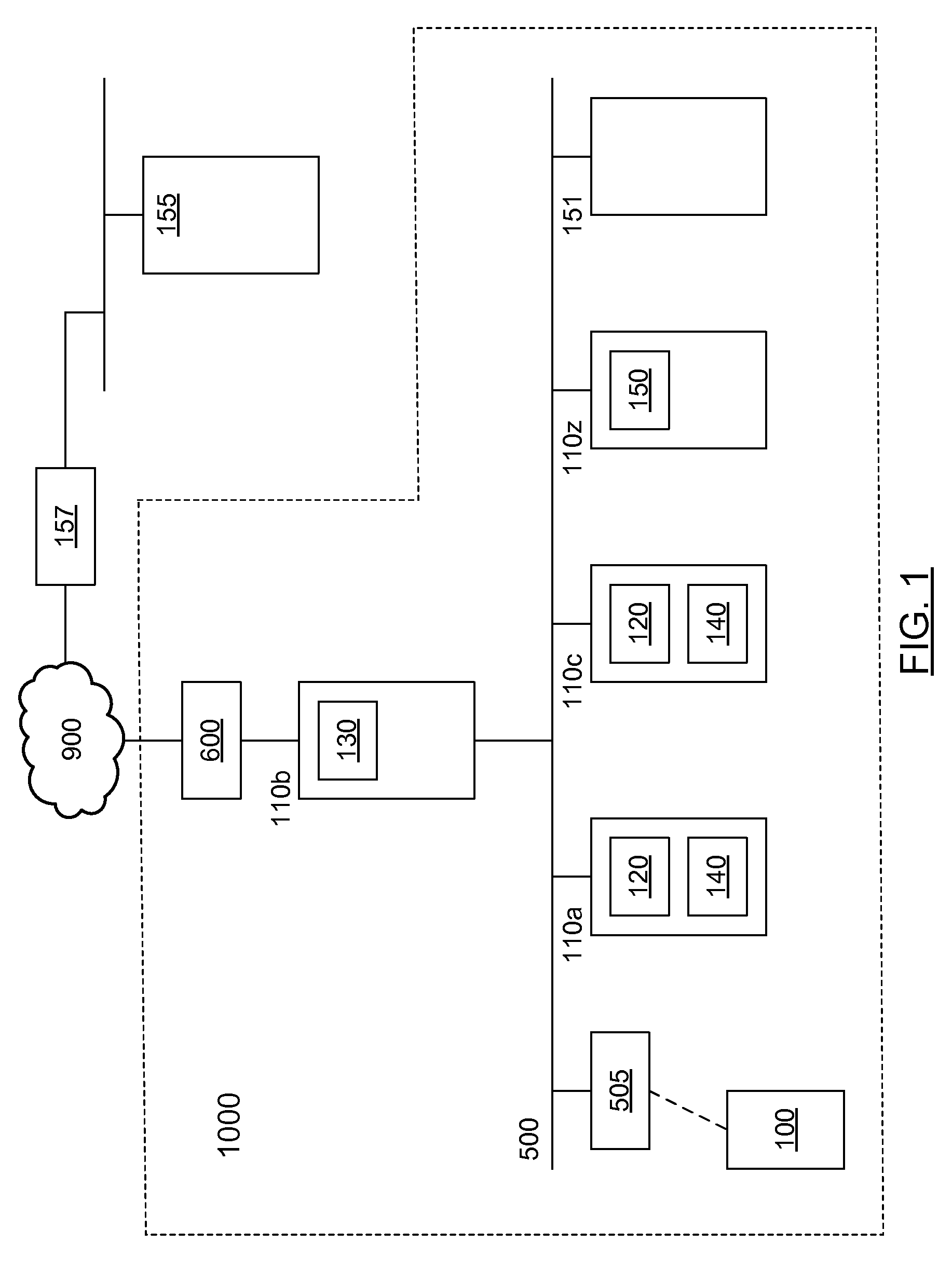

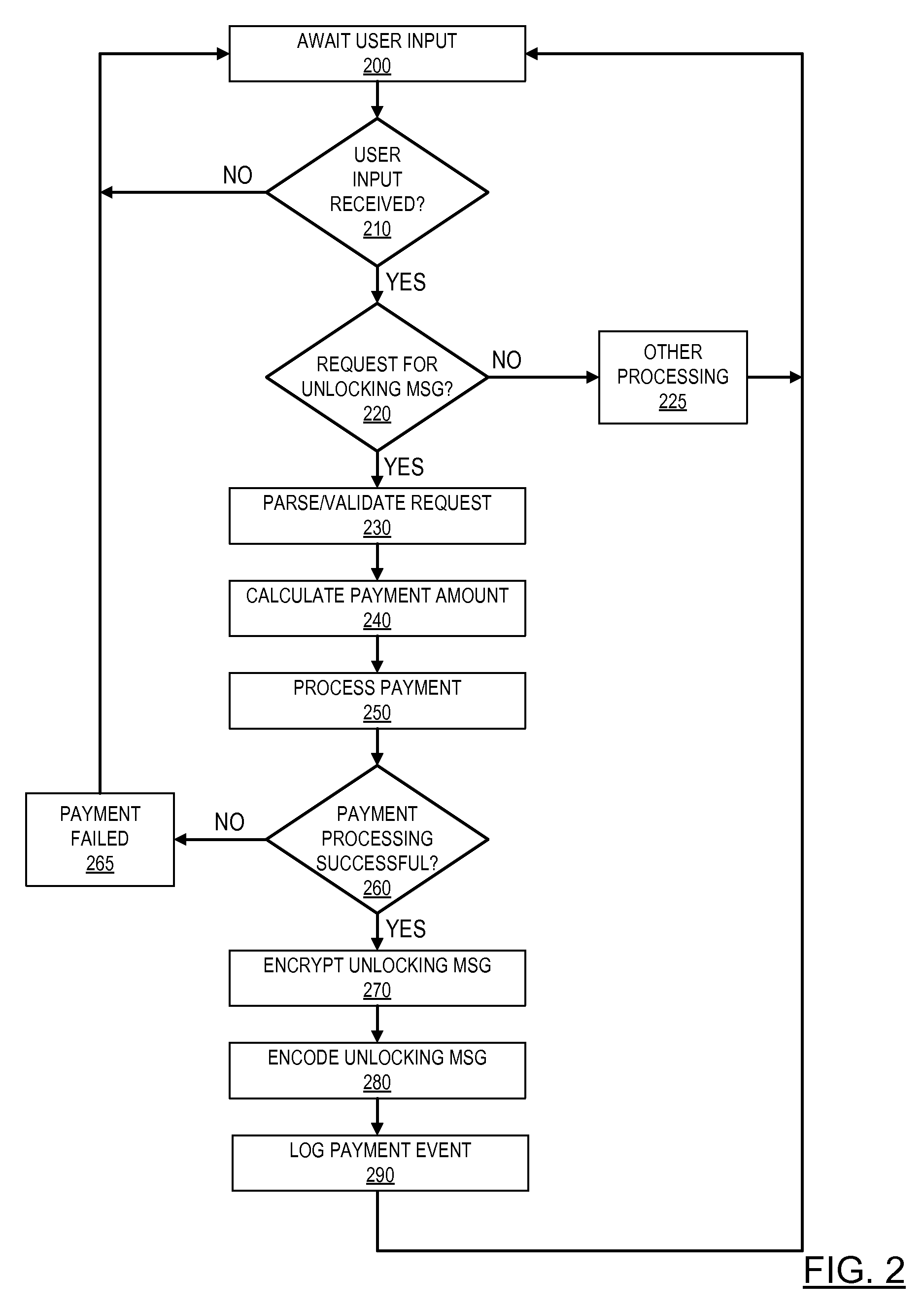

Pre-paid usage system for encoded information reading terminals

A fleet management system for managing a fleet of encoded information reading (EIR) terminals can comprise one or more computers, a fleet management software module, and a payment processing software module in communication with the fleet management software module. The fleet management software module can be configured, responsive to receiving a customer initiated request, to generate an unlocking message upon processing a payment by the payment processing software module. The unlocking message can be provided by a bar code to be read by an EIR terminal, or by a bit stream to be transferred to an EIR terminal via network. Each EIR terminal can be configured to perform not more than a pre-defined number of EIR operations responsive to receiving the unlocking message.

Owner:METROLOGIC INSTR

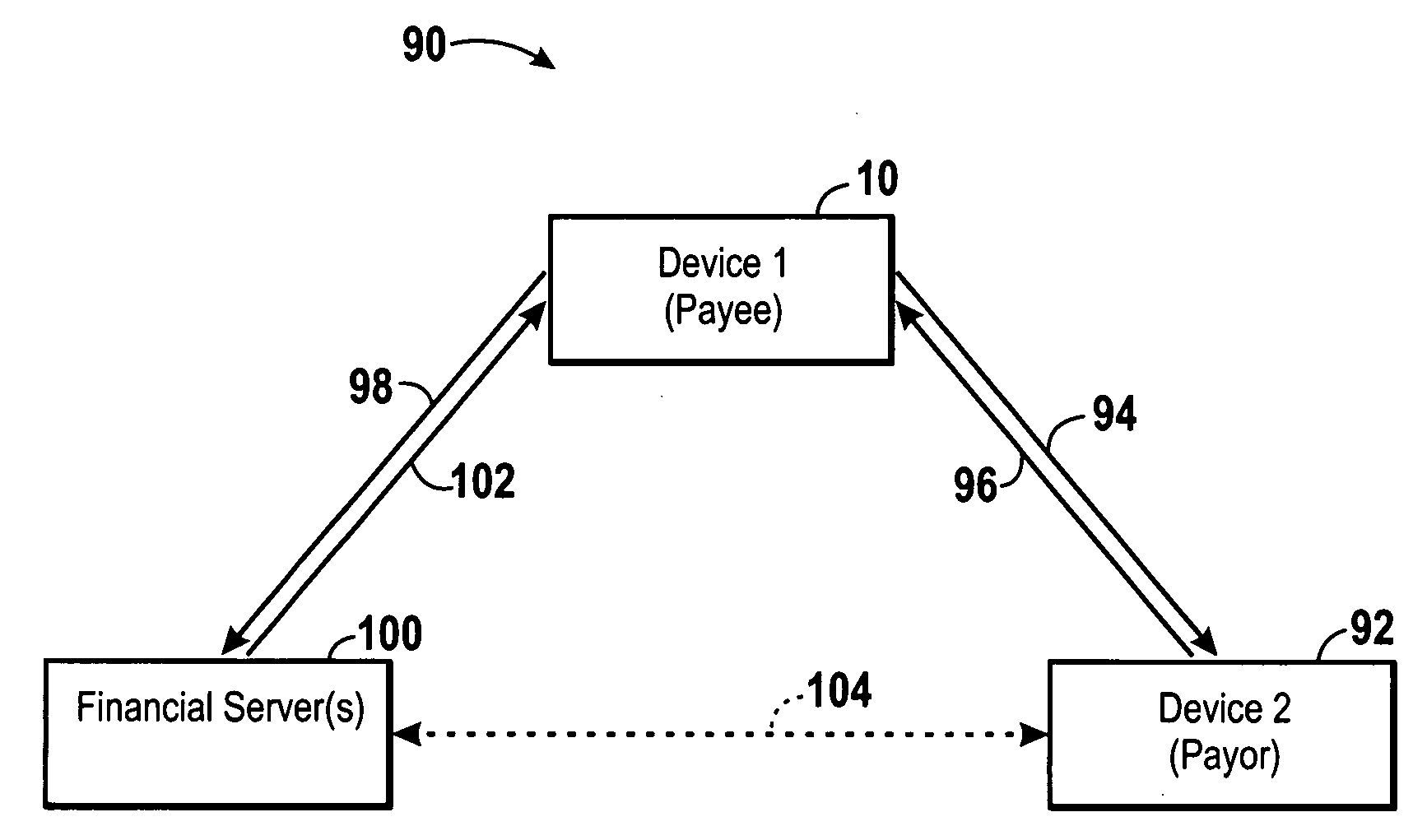

System and method for processing peer-to-peer financial transactions

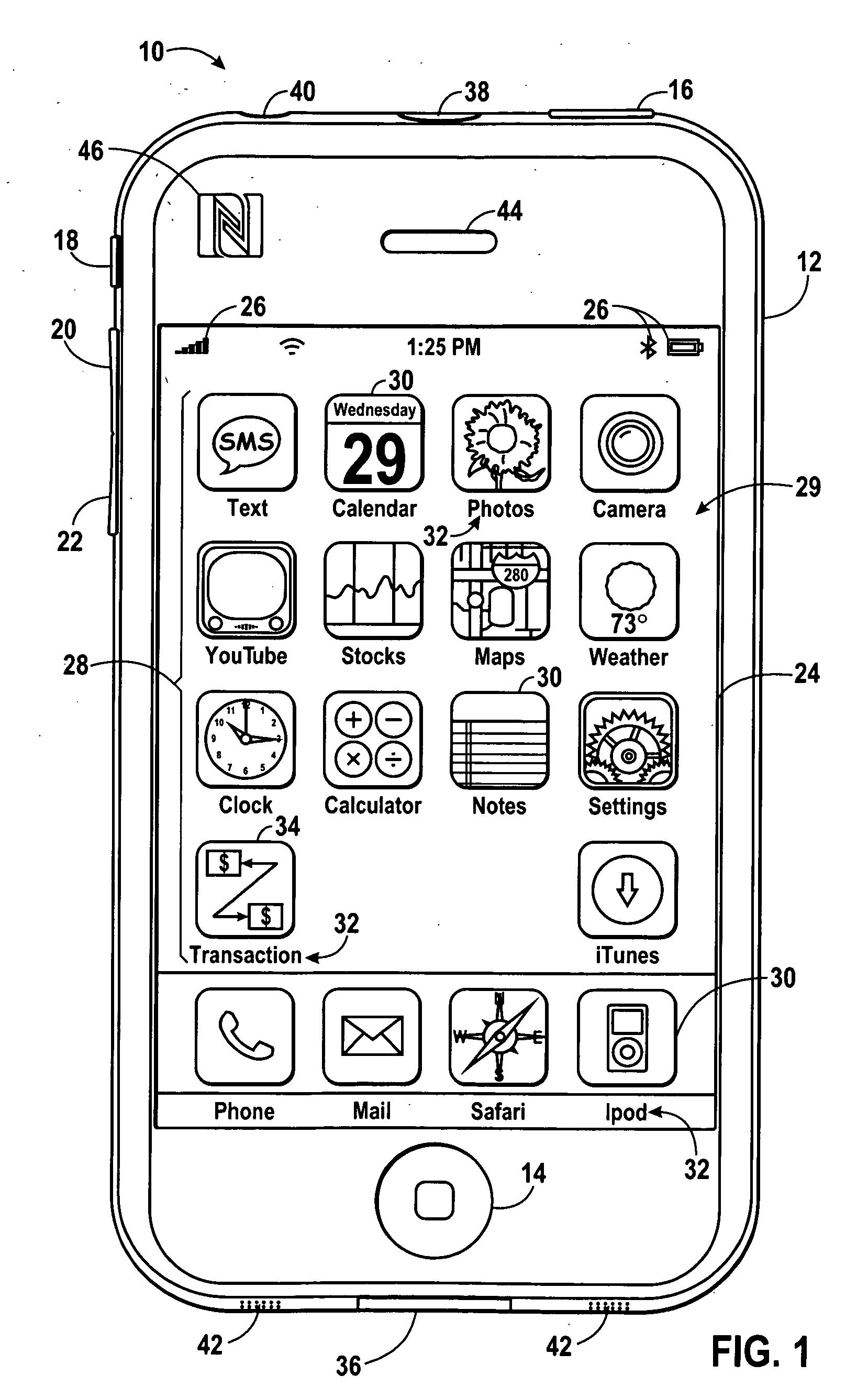

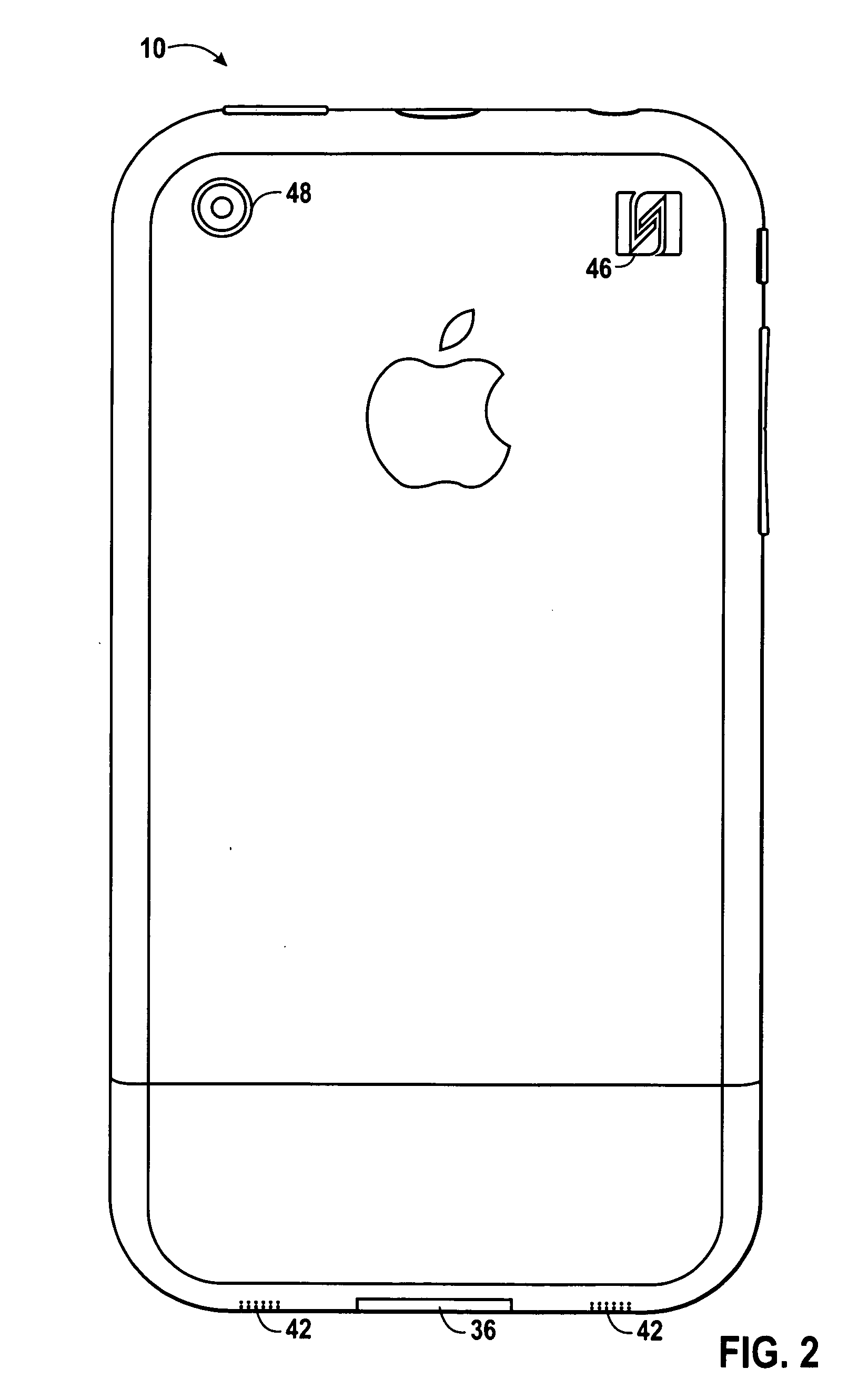

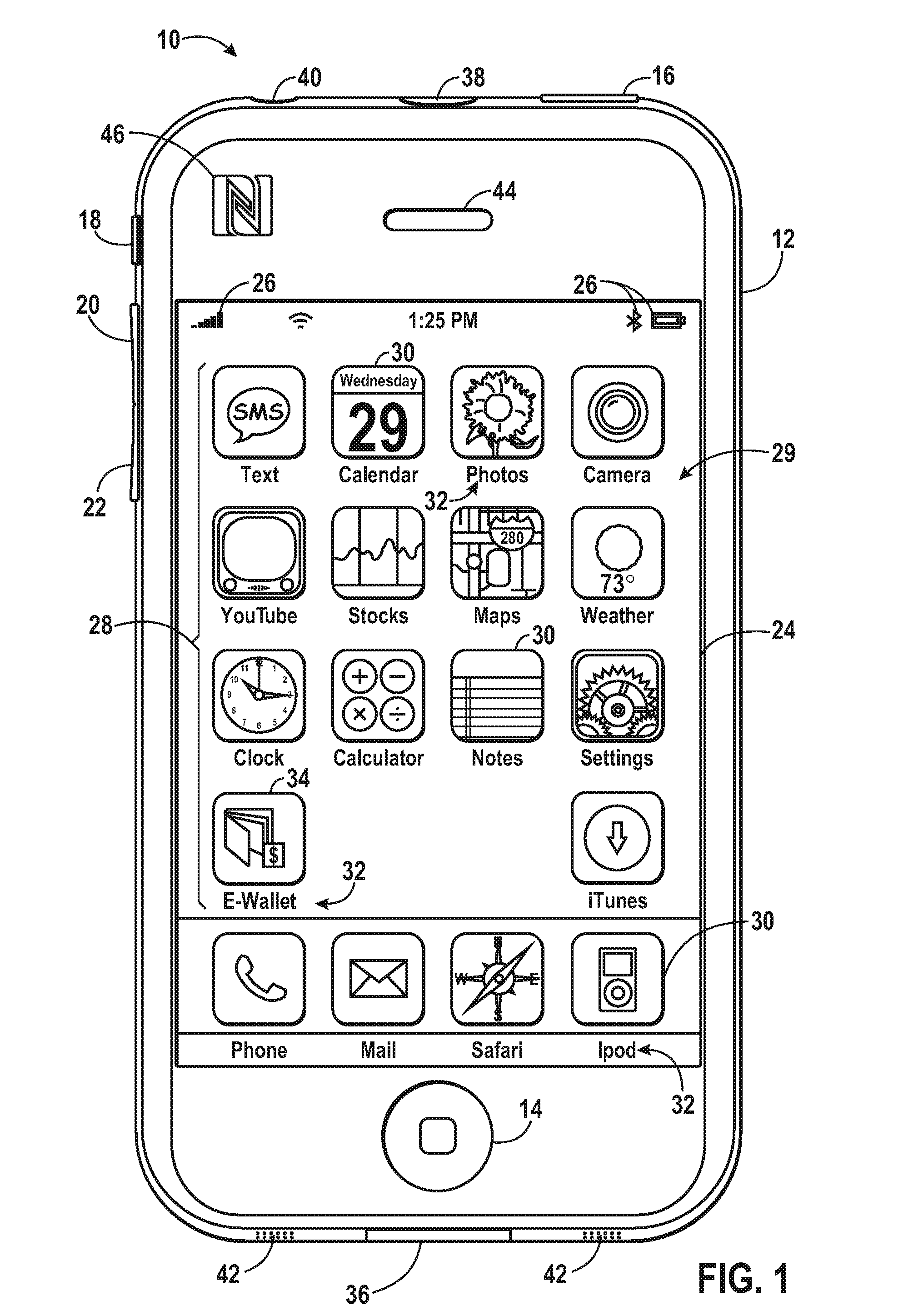

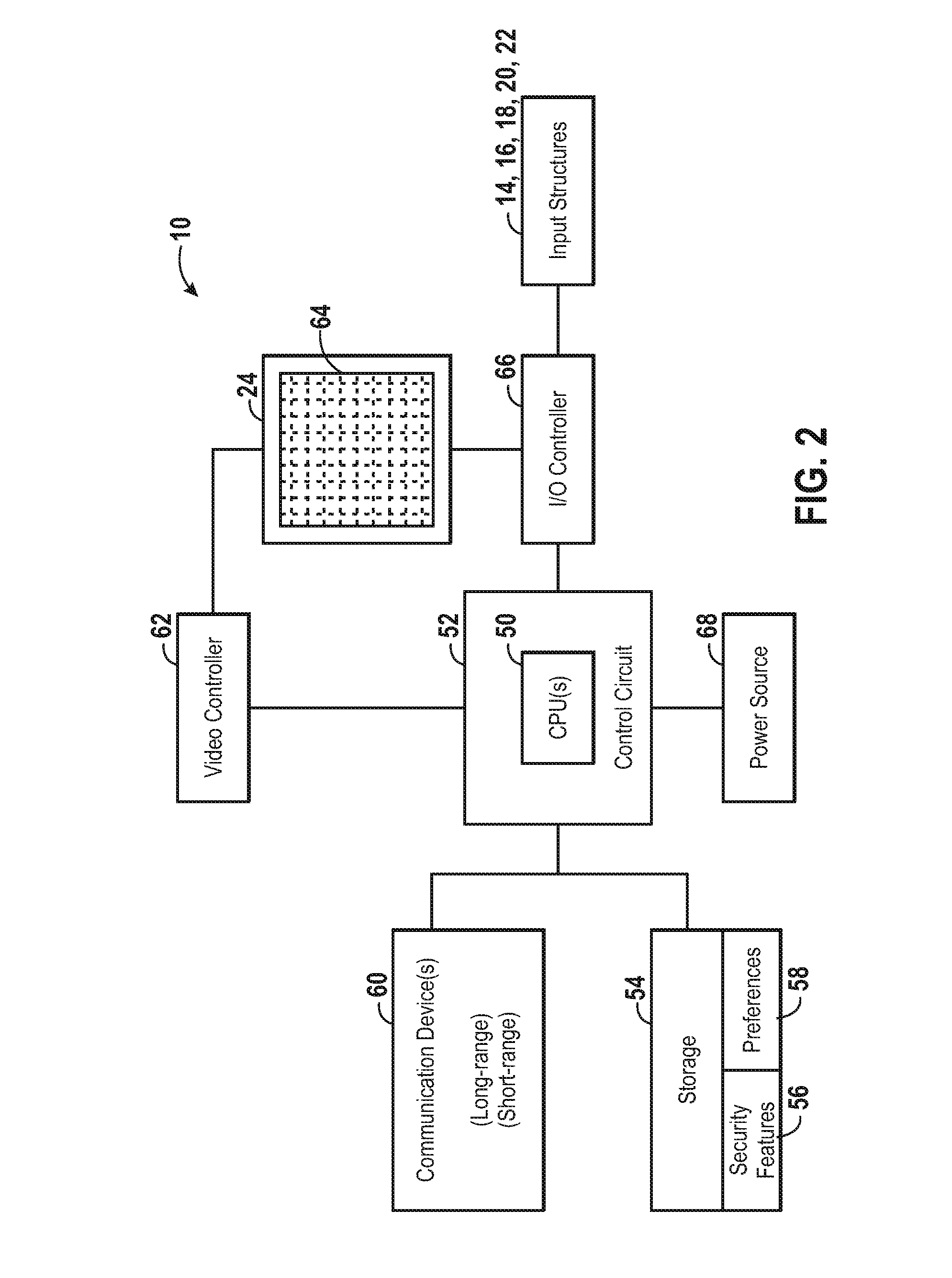

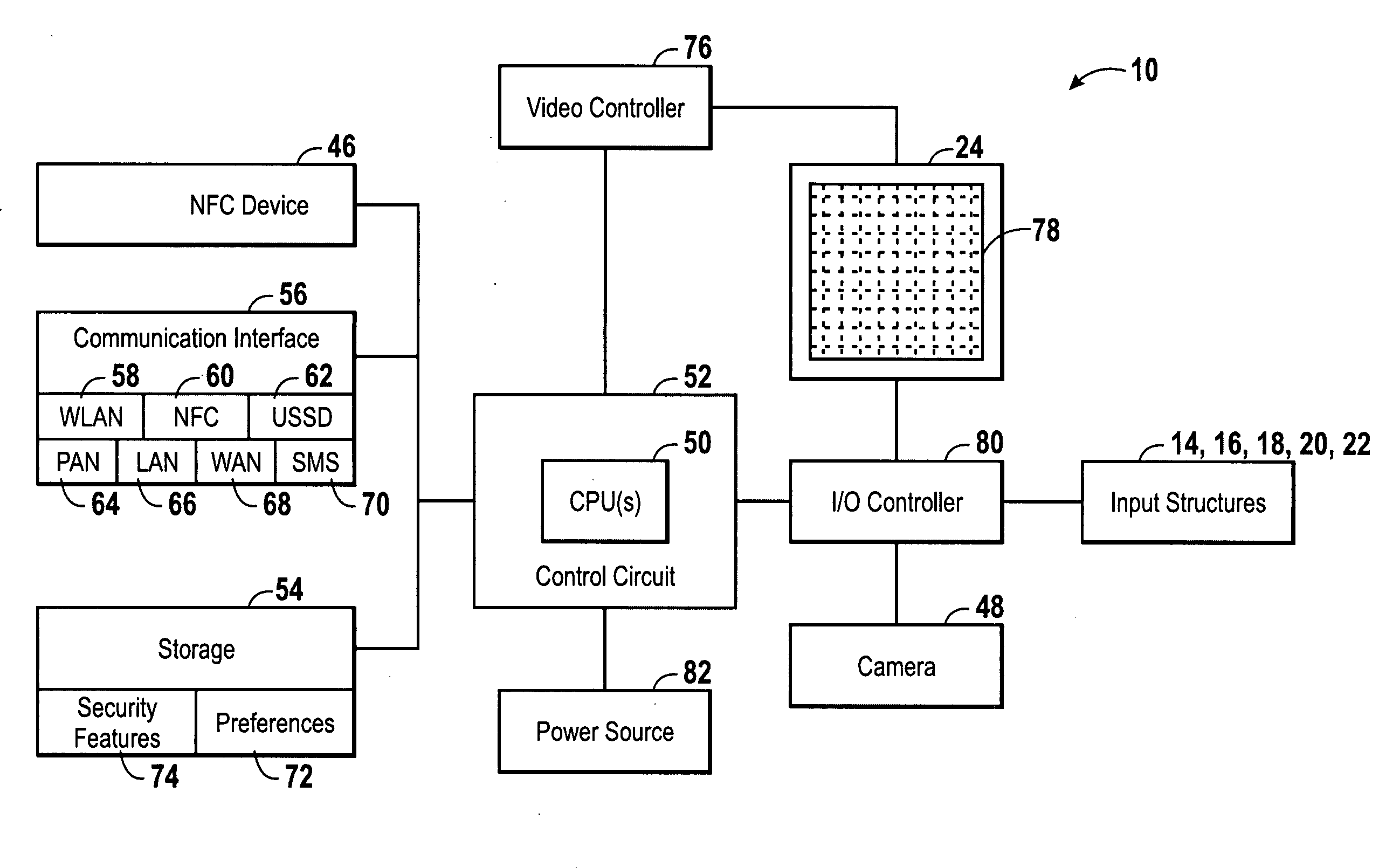

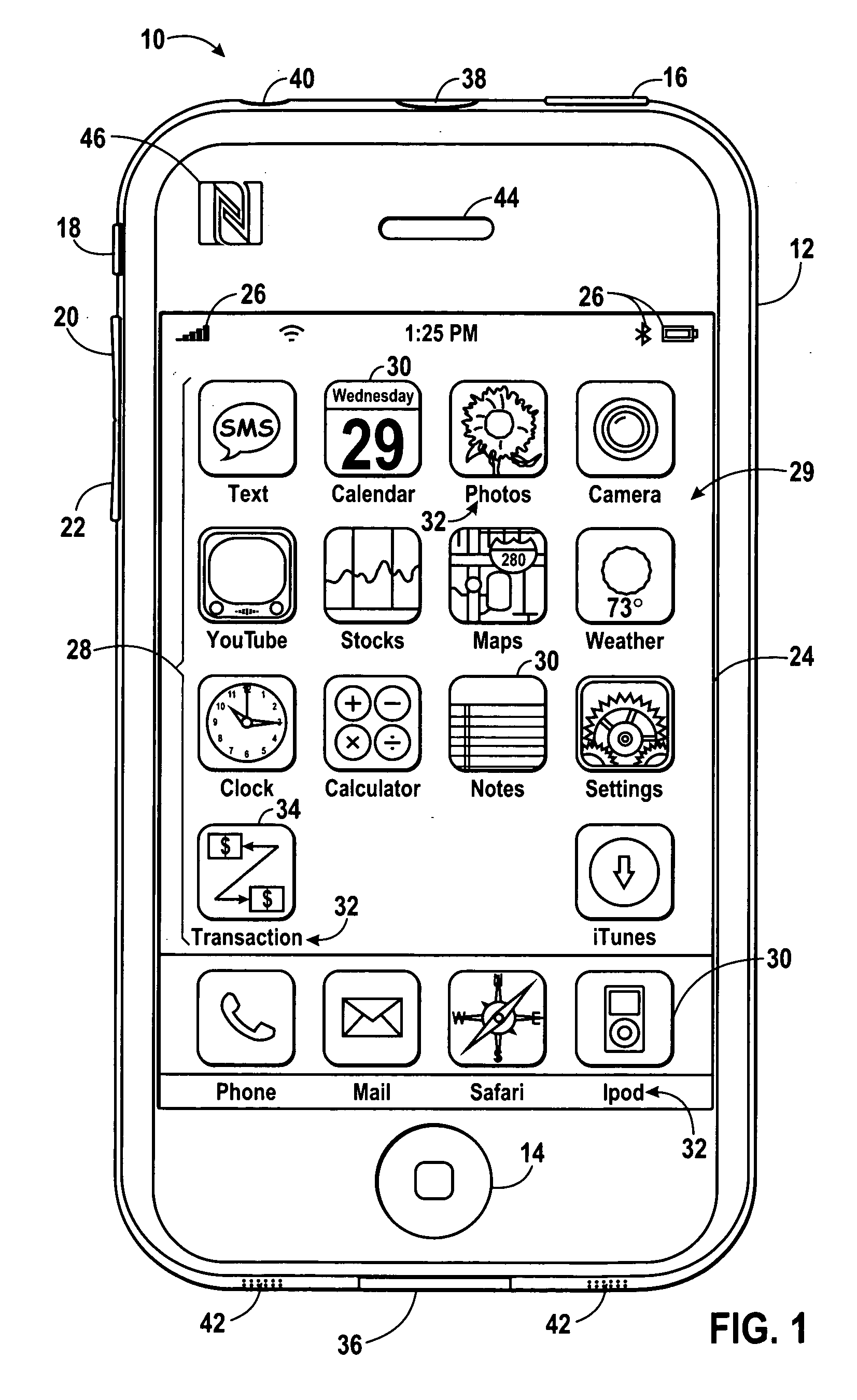

Various techniques are provided for carrying out peer-to-peer financial transactions using one or more electronic devices. In one embodiment, a request for payment is transmitted from a first device to a second device using a near field communication (NFC) interface. In response to the request, the second device may transmit payment information to the first device. The first device may select a crediting account and, using a suitable communication protocol, may communicate the received payment information and selected crediting account to one or more external financial servers configured to process and determine whether the payment may be authorized. If the payment is authorized, a payment may be credited to the selected crediting account. In a further embodiment, a device may include a camera configured to obtain an image of a payment instrument. The device may further include an application to extract payment information from the acquired image.

Owner:APPLE INC

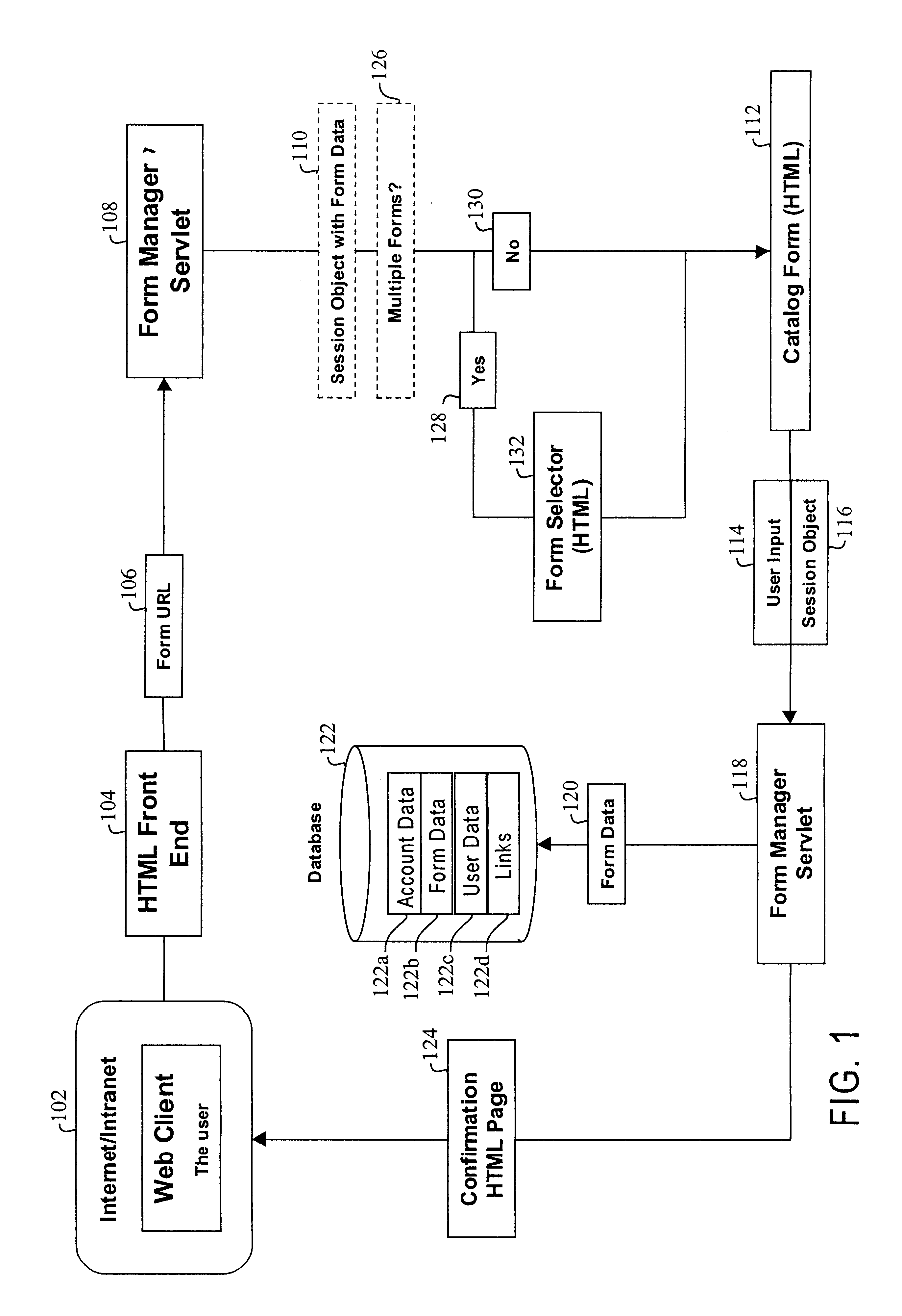

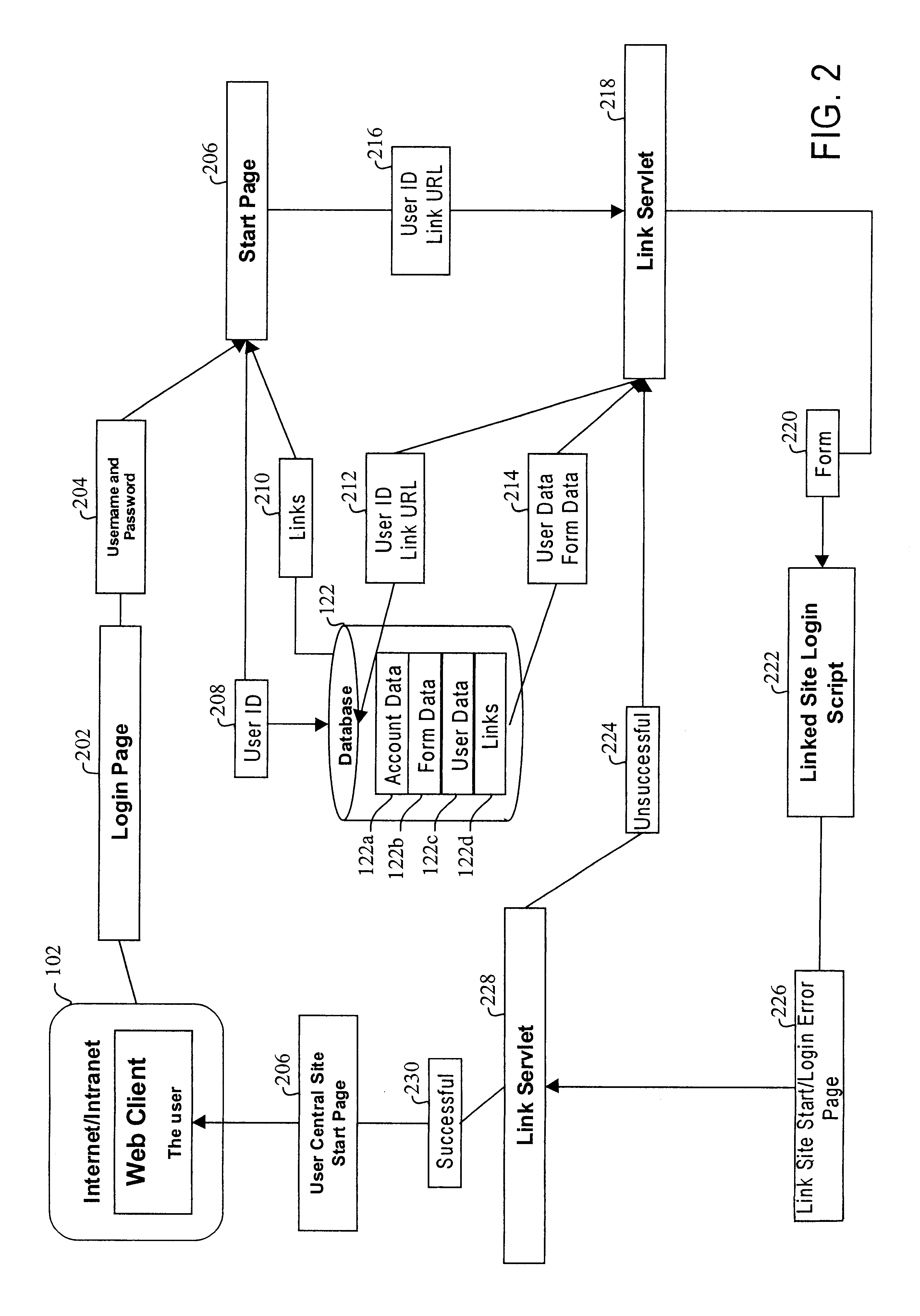

Method, system and computer readable medium for web site account and e-commerce management from a central location

InactiveUS6879965B2Minimizing activation timeMinimizing financial exposureComplete banking machinesAcutation objectsWeb siteData field

A method, system and computer readable medium for, from a central Web site, performing at least one of registering a user at a destination Web site, logging in a user at a destination Web site and managing an online financial transaction at a destination Web site, including parsing a form Web page of the destination Web site to extract form data fields therefrom; mapping form data fields of a central Web site form to corresponding extracted form data fields of the form Web page of the destination Web site; and using the mapped form data fields to perform at least one of registering a user at the destination Web site, logging in a user at the destination Web site and managing an online financial transaction of a user at the destination Web site. In another aspect, there is provided a method, system and computer readable medium for managing an online or offline financial transaction of a user, from a central Web site, including generating financial transaction account information for a user based on existing credit or debit card information; gathering from the user one or more limits that are applied to a financial transaction performed based on the financial transaction account information; receiving from a source information indicating that an online or offline financial transaction using the financial transaction account information is in progress; applying the one or more limits gathered from the user to approve or disapprove the online or offline or online financial transaction that is in progress; and transmitting an approval or disapproval signal to the source based on a result of the applying step.

Owner:SLINGSHOT TECH LLC

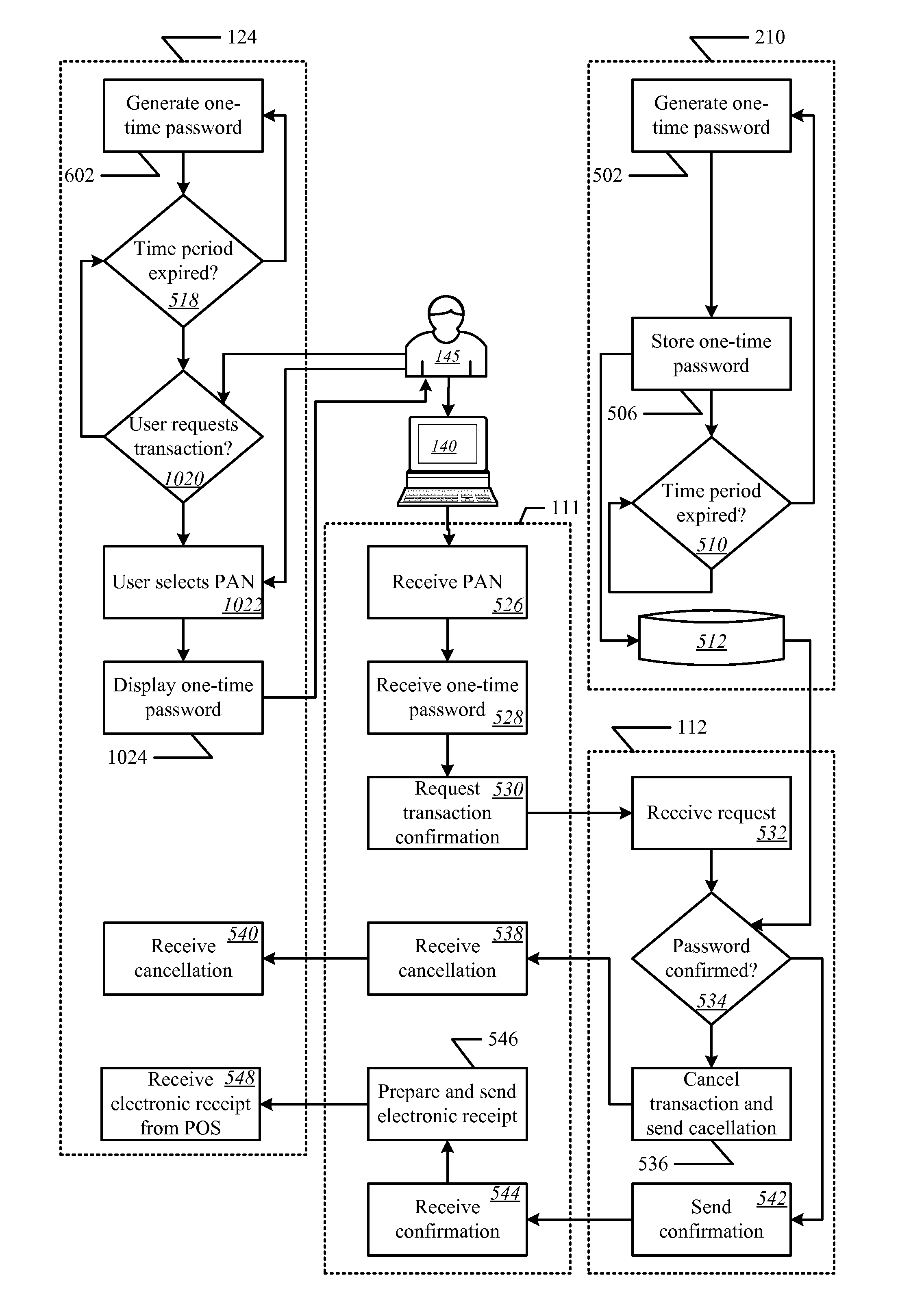

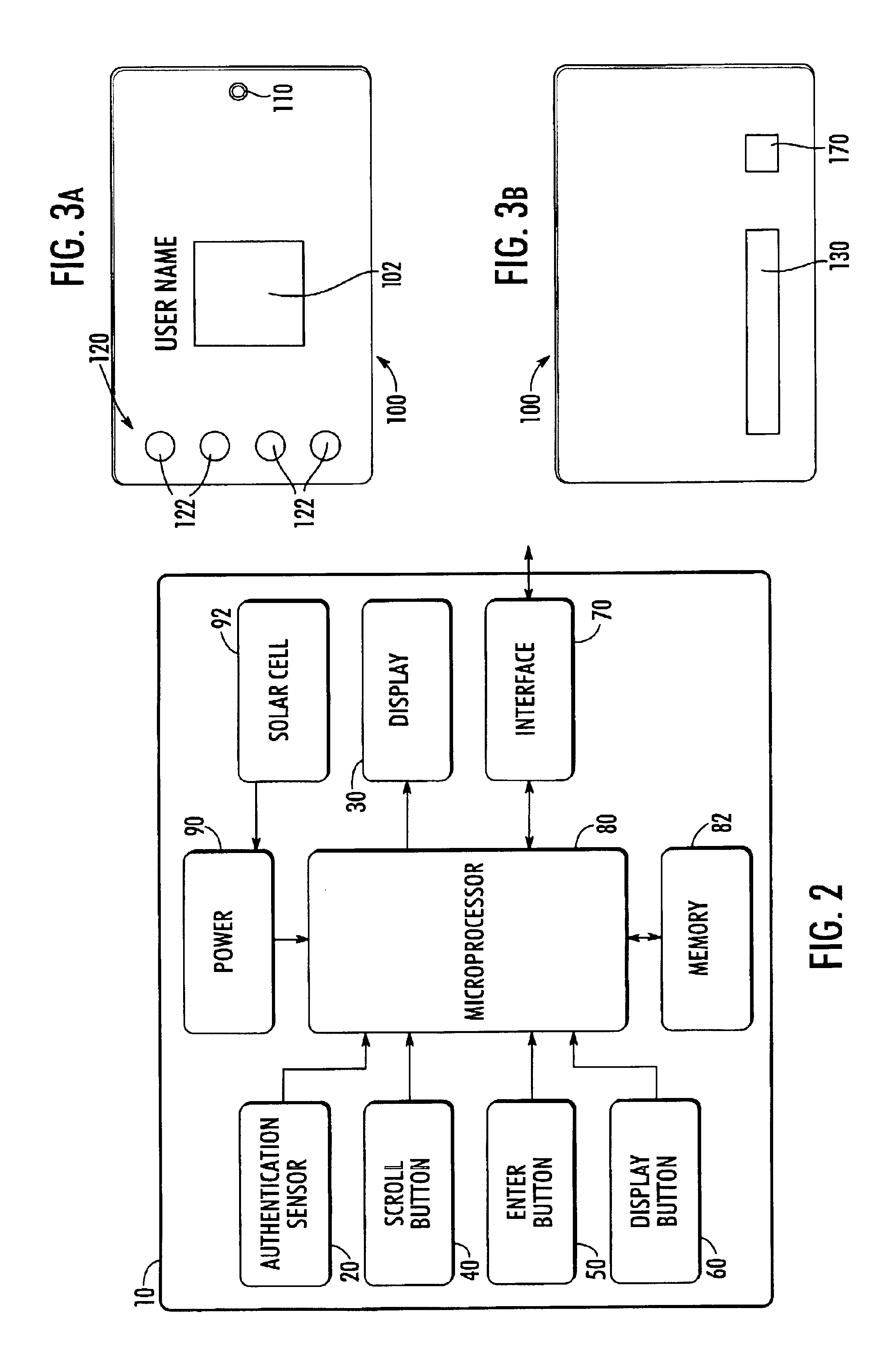

Onetime passwords for smart chip cards

ActiveUS8095113B2Unauthorised/fraudulent call preventionEavesdropping prevention circuitsDisplay deviceFinancial transaction

A financial transaction card is provided according to various embodiments described herein. The financial transaction card includes a card body with at least a front surface and a back surface. The financial transaction card may also include a near field communications transponder and / or a magnetic stripe, as well as a digital display configured to display alphanumeric characters on the front surface of the card body. The financial transaction card may also include a processor that is communicatively coupled with the near field communications transponder or magnetic stripe and the digital display. The processor may be configured to calculate one-time passwords and communicate the one-time passwords to both the near filed communications transponder or magnetic stripe and the digital display.

Owner:FIRST DATA

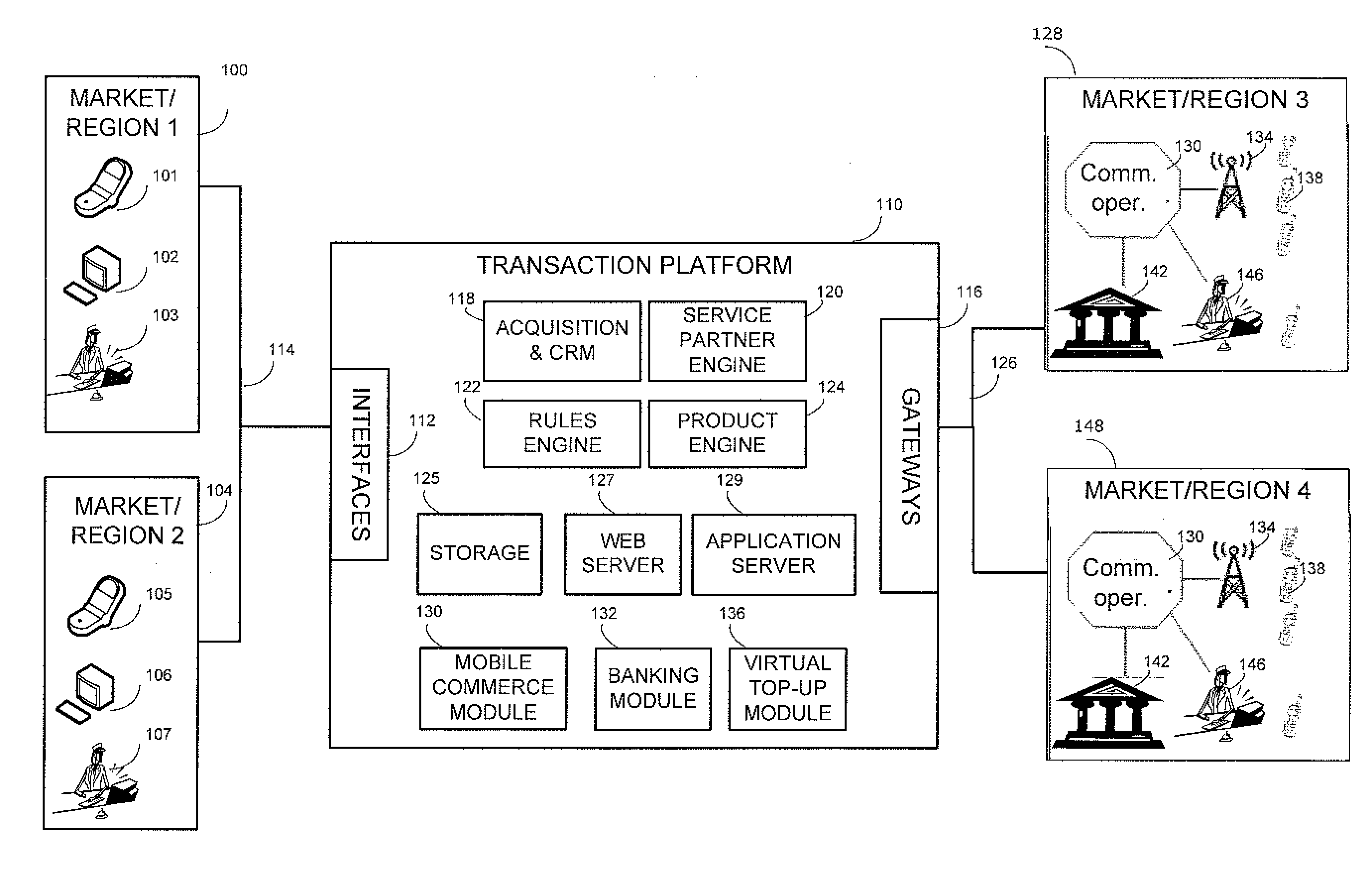

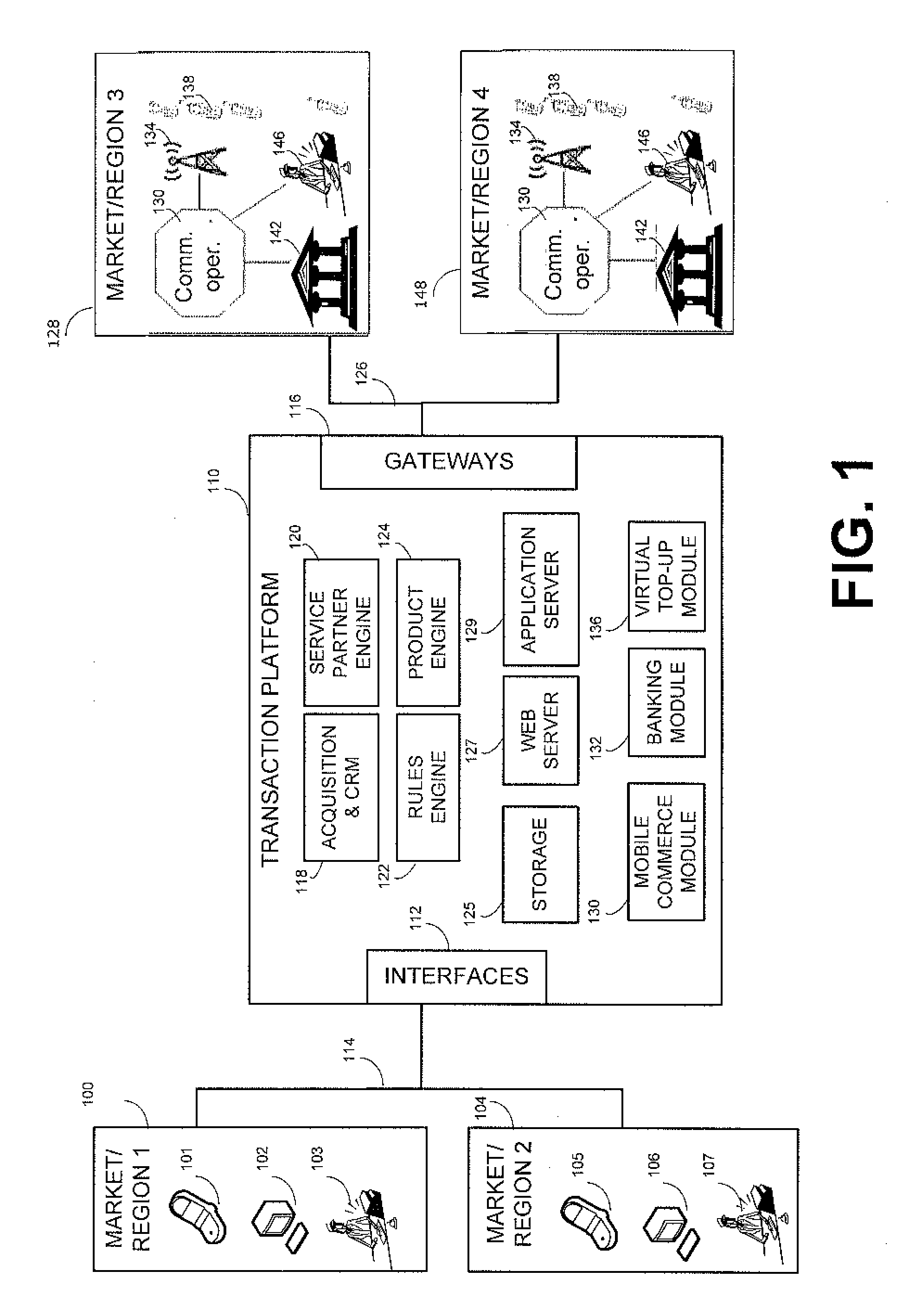

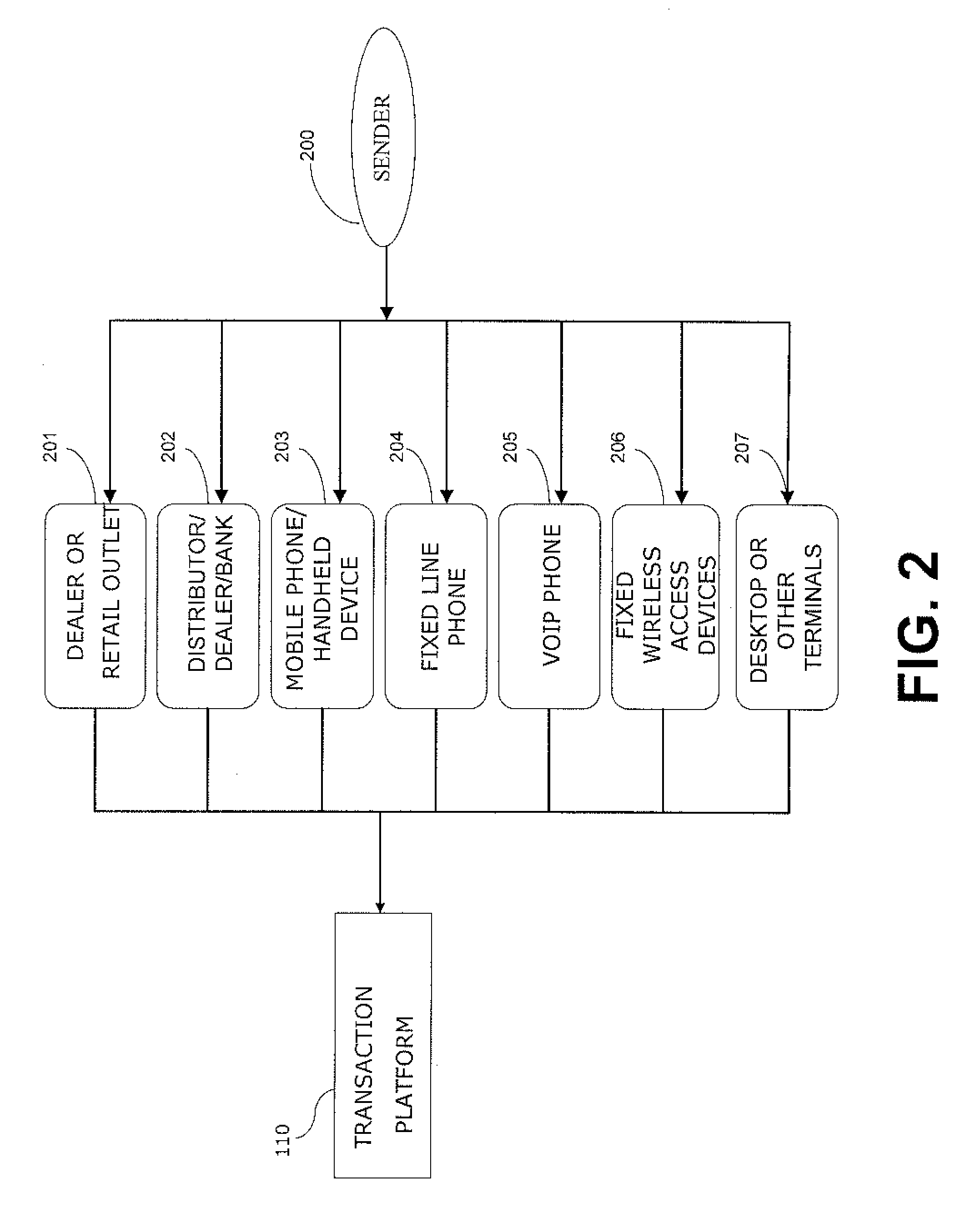

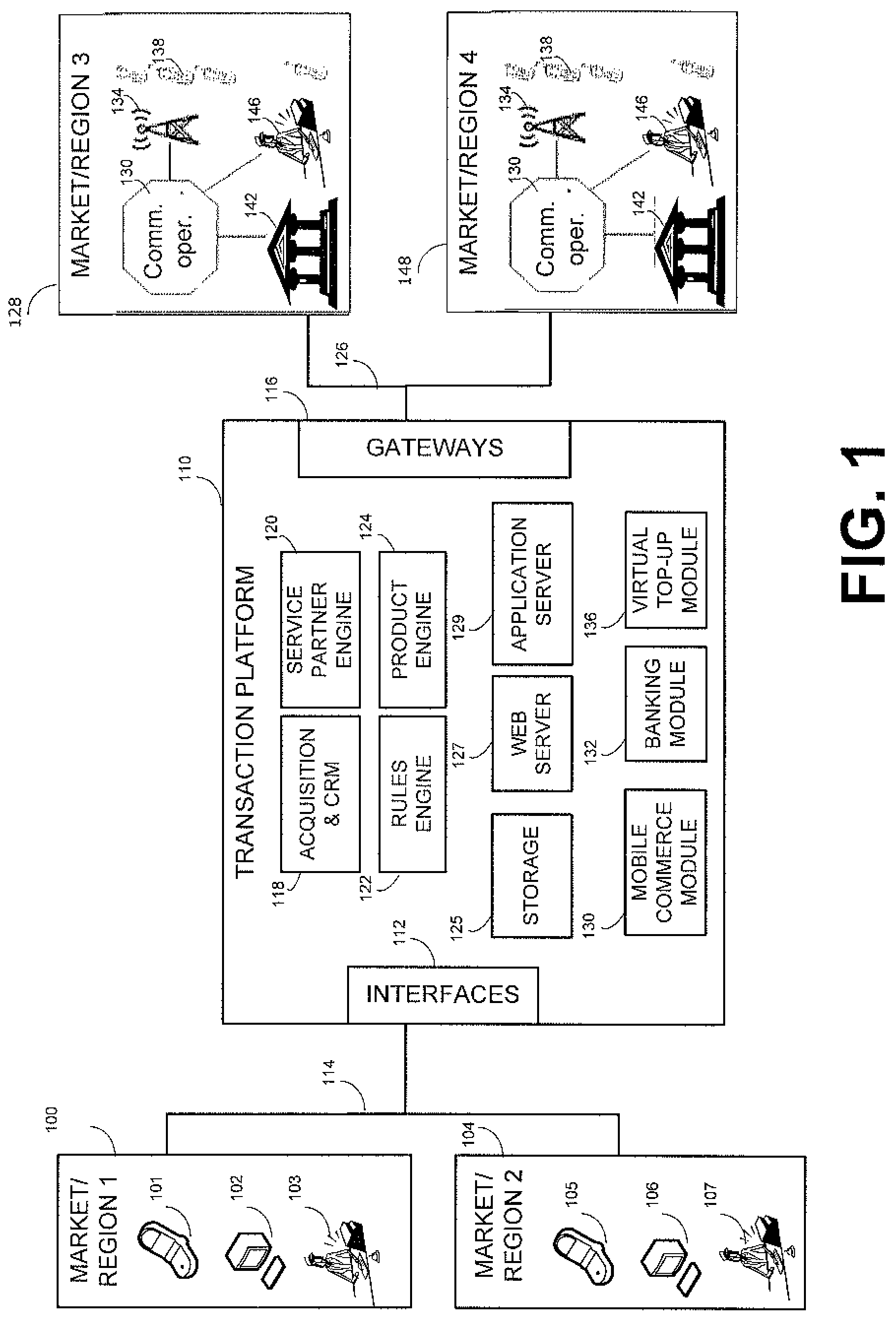

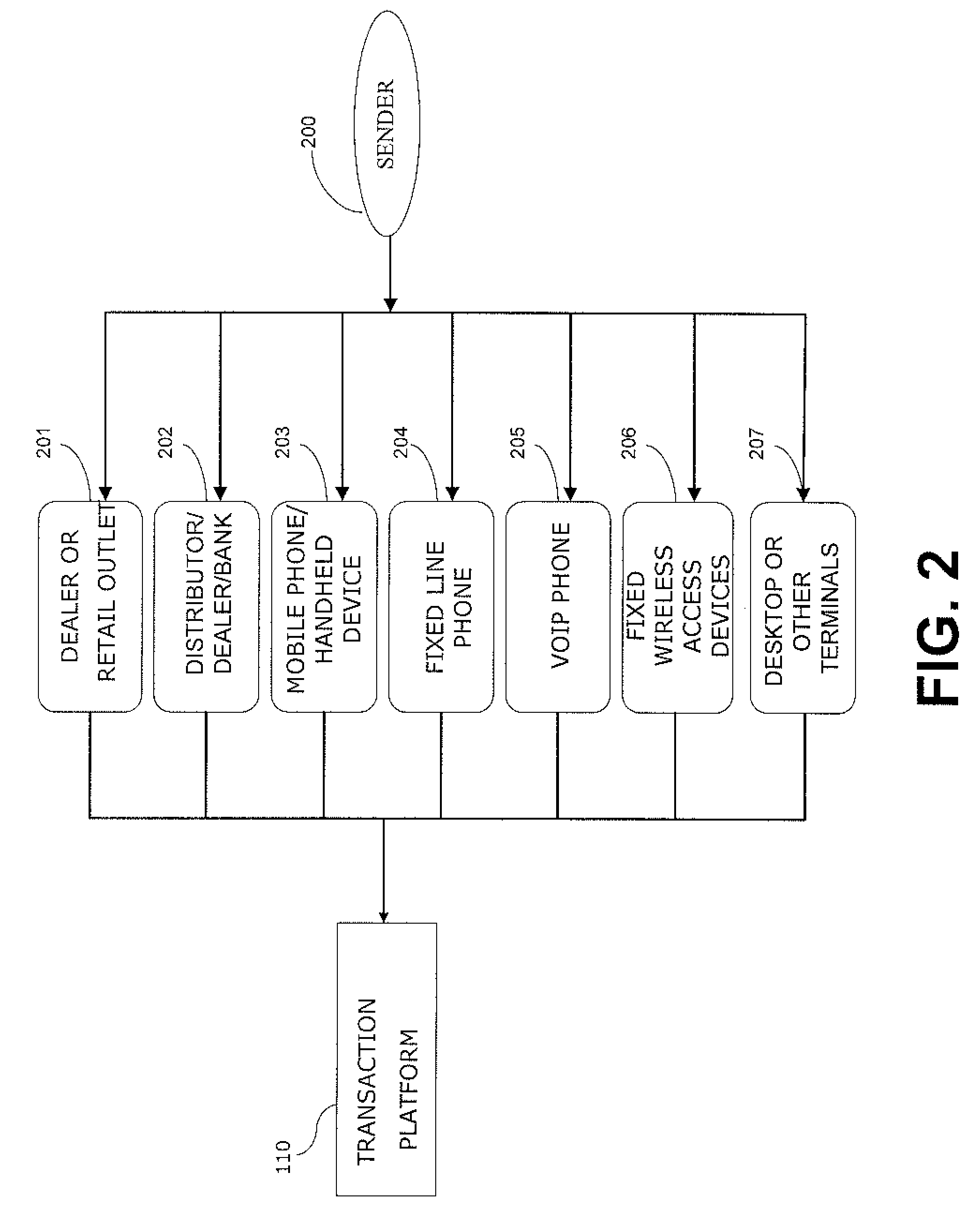

Apparatus and method for facilitating money or value transfer

An apparatus and method for transferring money or value, using a wide range of interfaces to initiate a transfer and a wide range of options for receiving the transfer, including receiving the transferred sum directly to the communication device / account of the receiver. The receiver can use the transferred sum as an airtime credit, to obtain cash or to pay for other goods or services.

Owner:HIP CONSULT

Method and system for facilitating electronic funds transactions

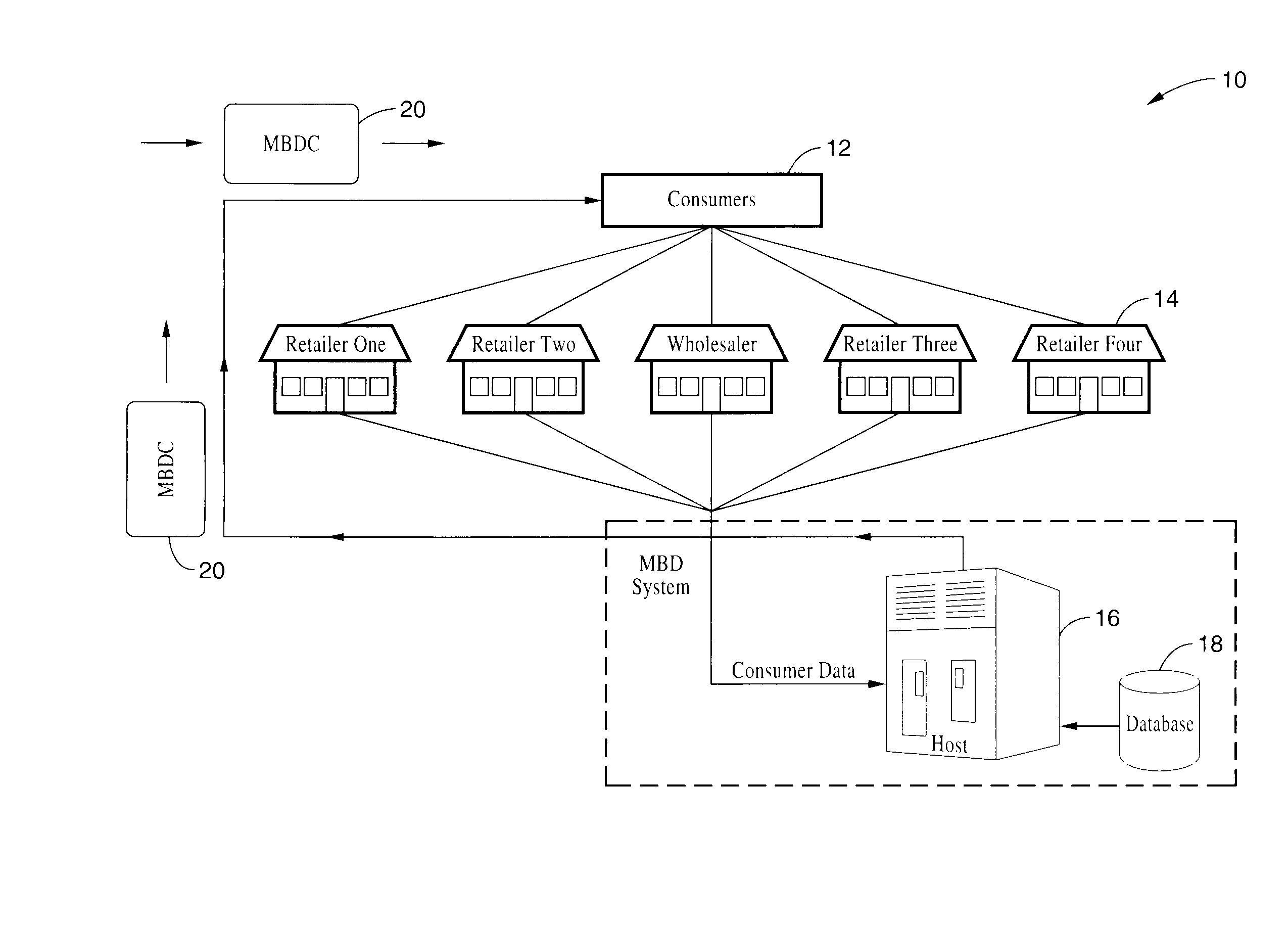

InactiveUS7104443B1Measurement is limitedReduce transaction costsComplete banking machinesFinanceInformation sharingMerchant account

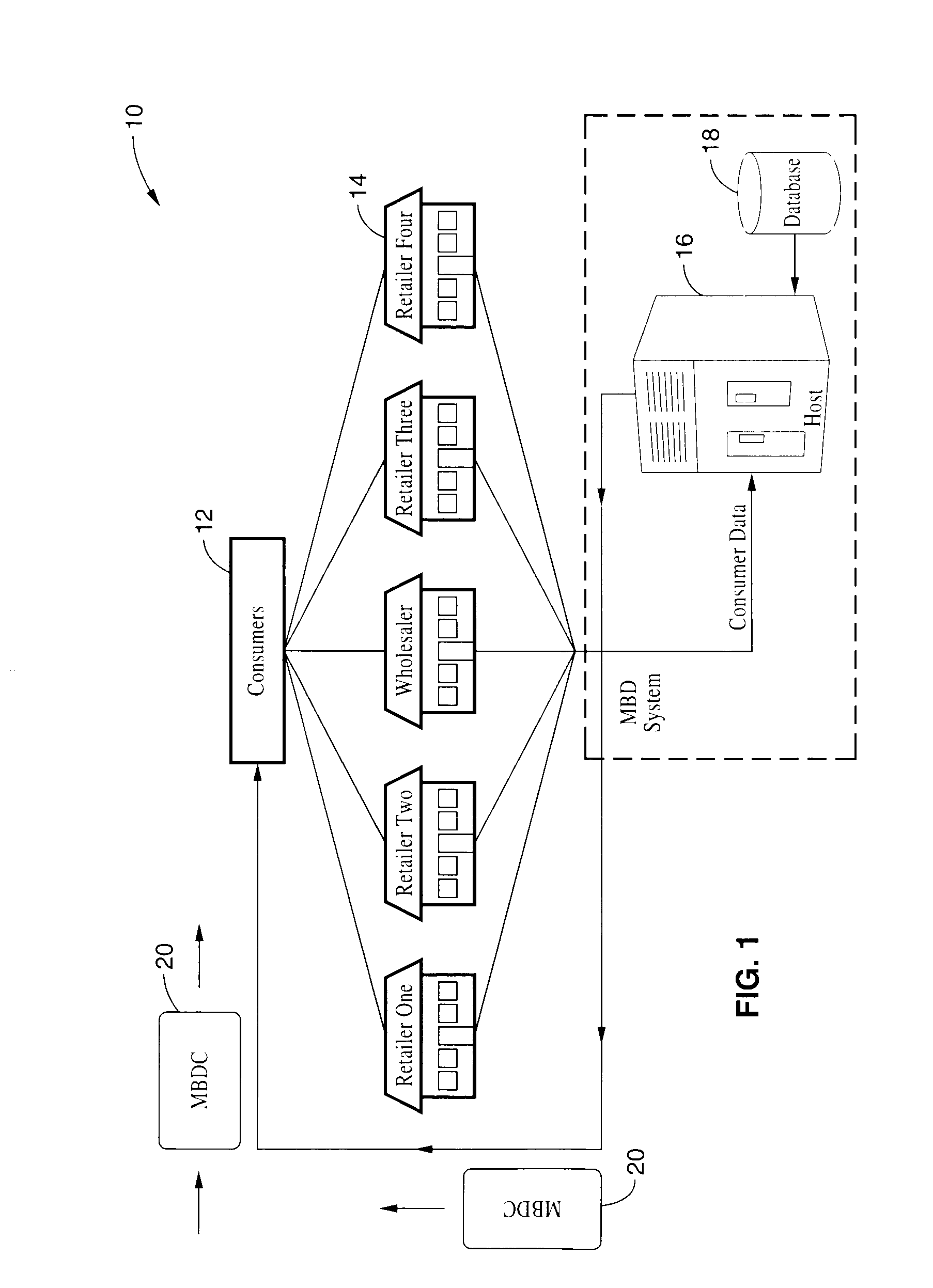

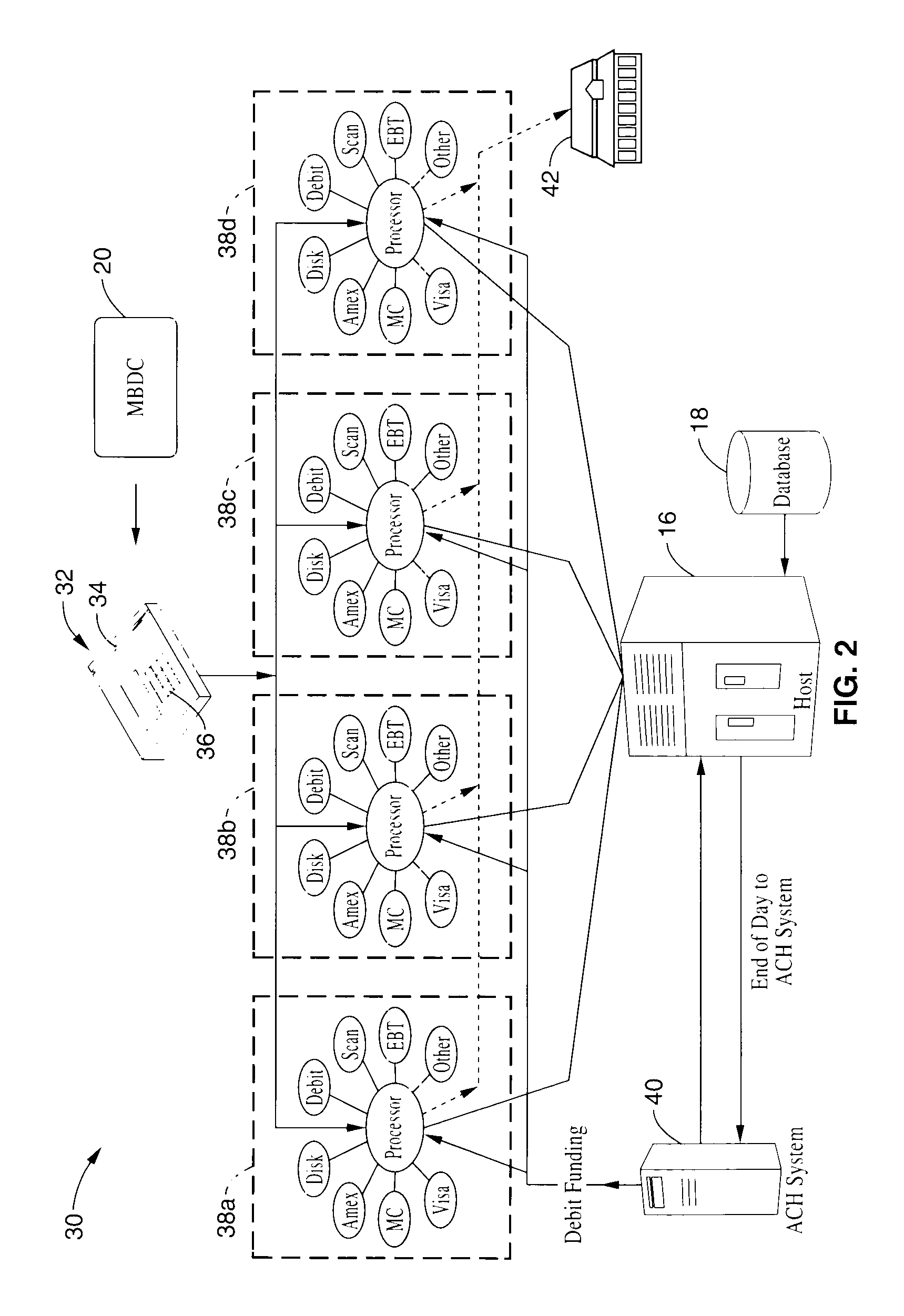

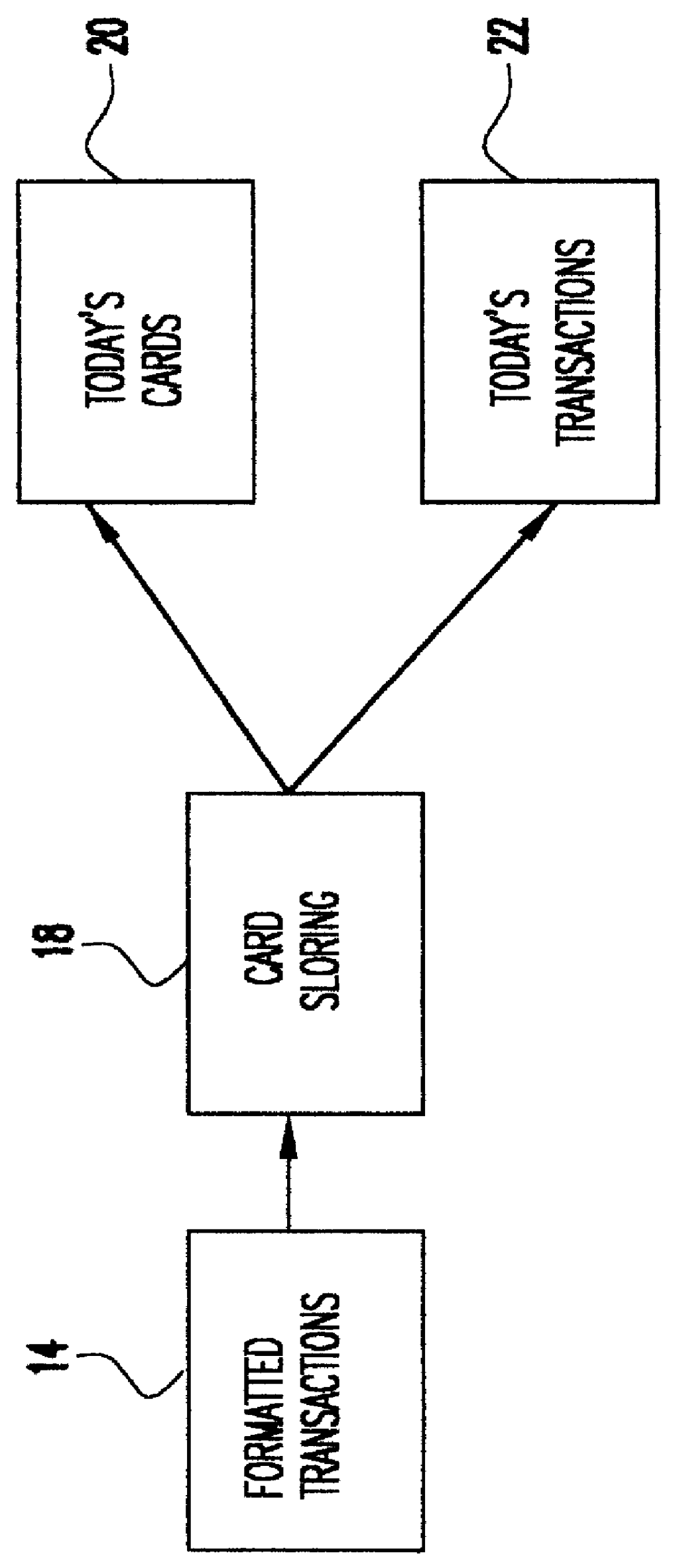

A method and system for executing electronic funds transactions using a merchant based debit (MBD) card in a merchant-centric system that provides for reduced fees to acquiring merchants and remitting a portion of the collected fees to issuing merchants. The system also preferably provides information sharing on consumer transactions with merchants to facilitate consumer based incentive programs and the like. The system operates over conventional card processing infrastructure and utilizes the ACH network, or equivalent, to settle the transaction from a consumer checking account, or a merchant account in the case of a prepaid MBD card. Using the system, merchants may elect to qualify customers based on their own criterion. A portion of the interchange fee is distributed to the issuing merchant associated transaction executed using the merchant based debit card. Embodiments are described for prepaid, fixed value, programmable, and refillable, forms of merchant based debit cards.

Owner:KIOBA PROCESSING LLC

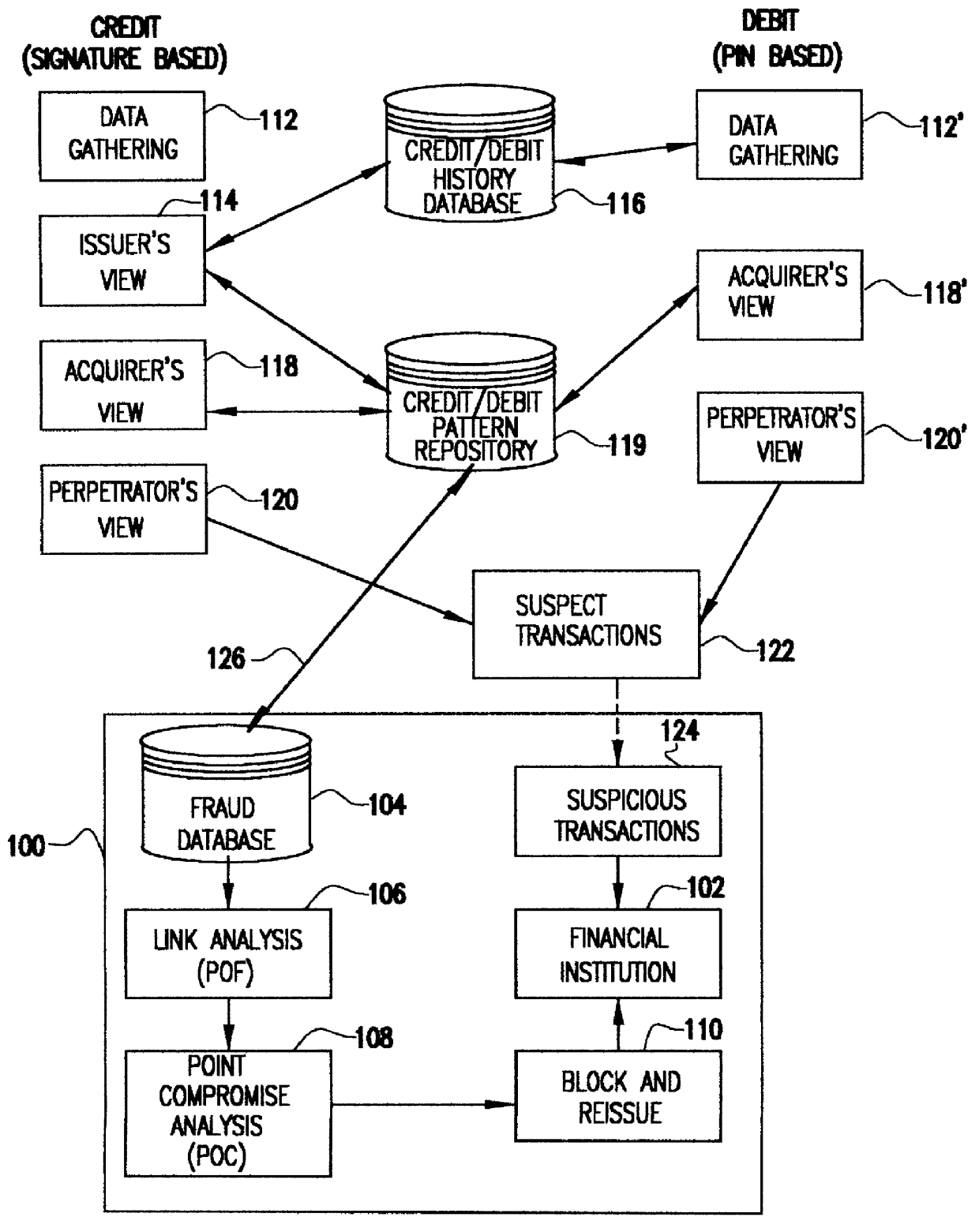

System for detecting counterfeit financial card fraud

Counterfeit financial card fraud is detected based on the premise that the fraudulent activity will reflect itself in clustered groups of suspicious transactions. A system for detecting financial card fraud uses a computer database comprising financial card transaction data reported from a plurality of financial institutions. The transactions are scored by assigning weights to individual transactions to identify suspicious transactions. The geographic region where the transactions took place as well as the time of the transactions are recorded. An event building process then identifies cards involved in suspicious transactions in a same geographic region during a common time period to determine clustered groups of suspicious activity suggesting an organized counterfeit card operation which would otherwise be impossible for the individual financial institutions to detect.

Owner:FAIR ISAAC & CO INC

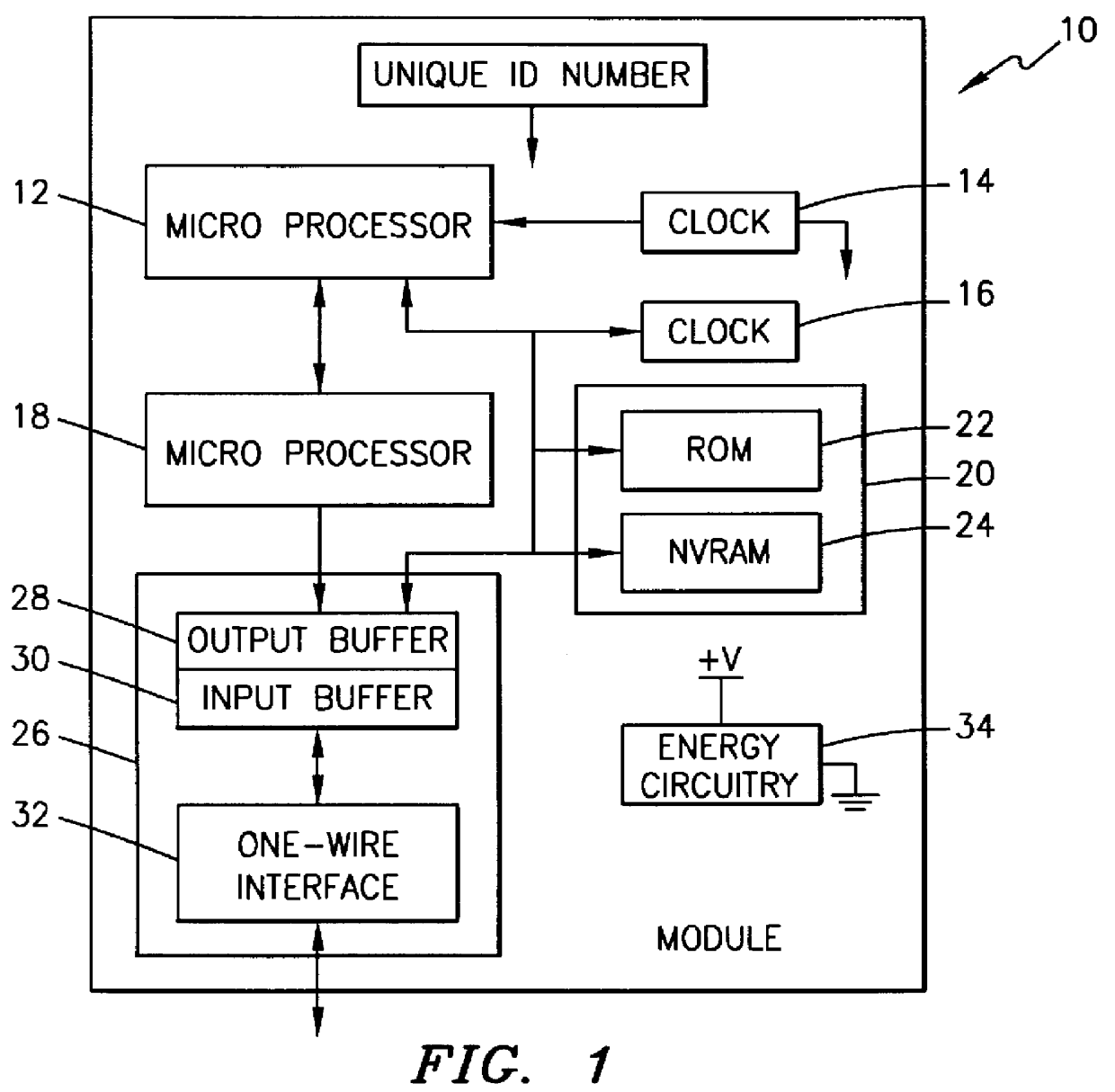

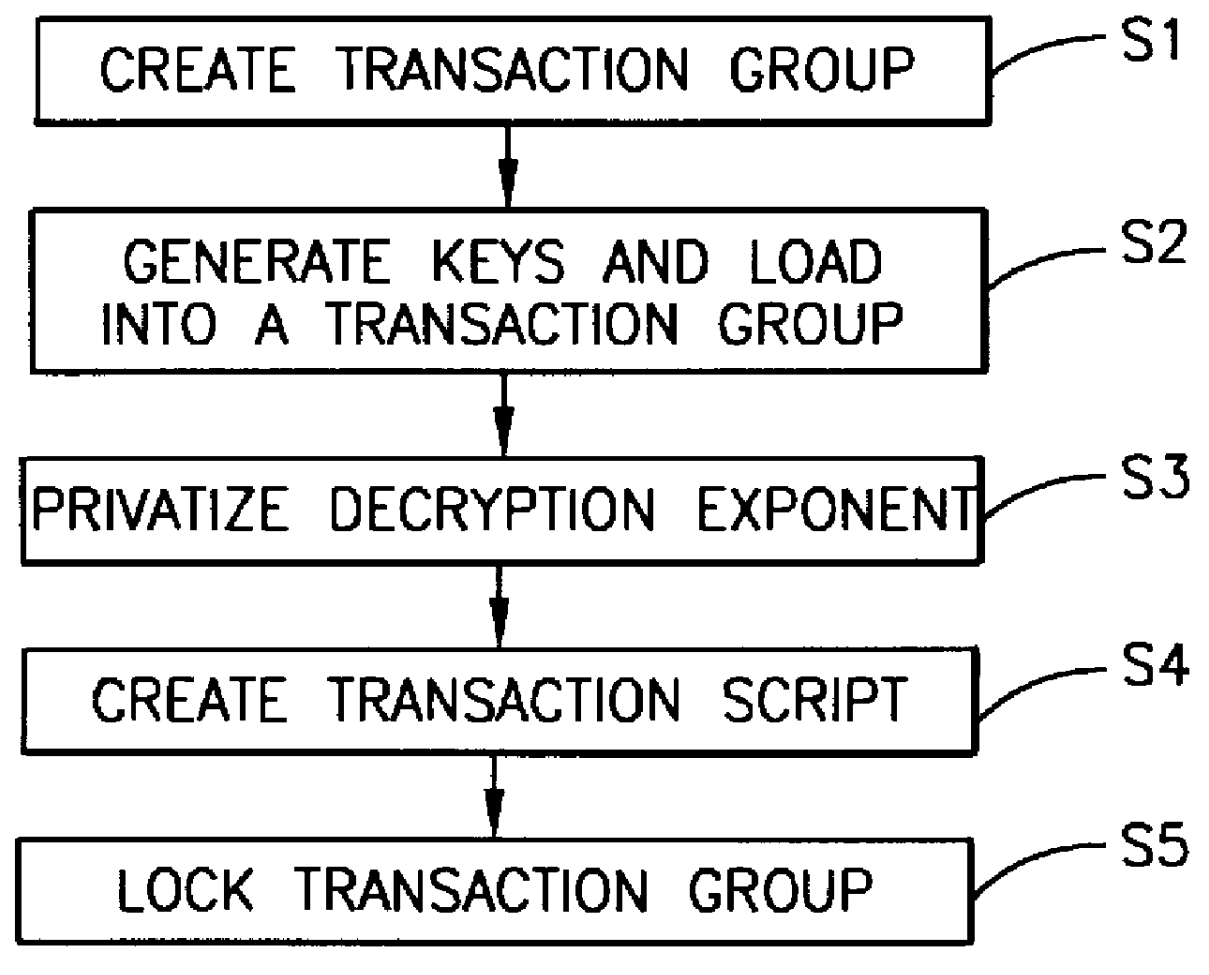

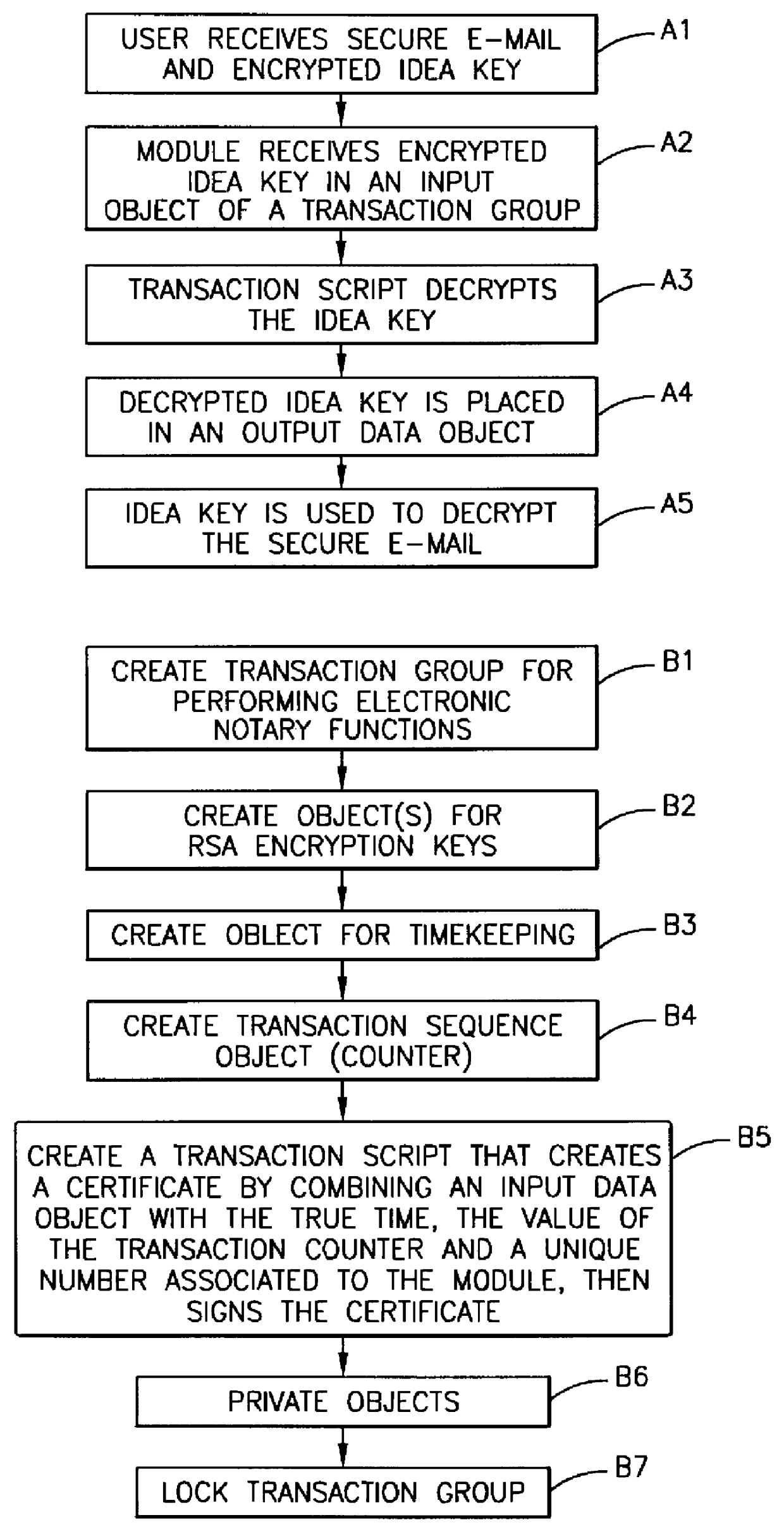

Method, apparatus, system and firmware for secure transactions

The present invention relates to an electronic module used for secure transactions. More specifically, the electronic module is capable of passing information back and forth between a service provider's equipment via a secure, encrypted technique so that money and other valuable data can be securely passed electronically. The module is capable of being programmed, keeping track of real time, recording transactions for later review, and creating encryption key pairs.

Owner:MAXIM INTEGRATED PROD INC

Apparatus and method for facilitating money or value transfer

An apparatus and method for transferring money or value, using a wide range of interfaces to initiate a transfer and a wide range of options for receiving the transfer, including receiving the transferred sum directly to the communication device / account of the receiver. The receiver can use the transferred sum as an airtime credit, to obtain cash or to pay for other goods or services.

Owner:HIP CONSULT

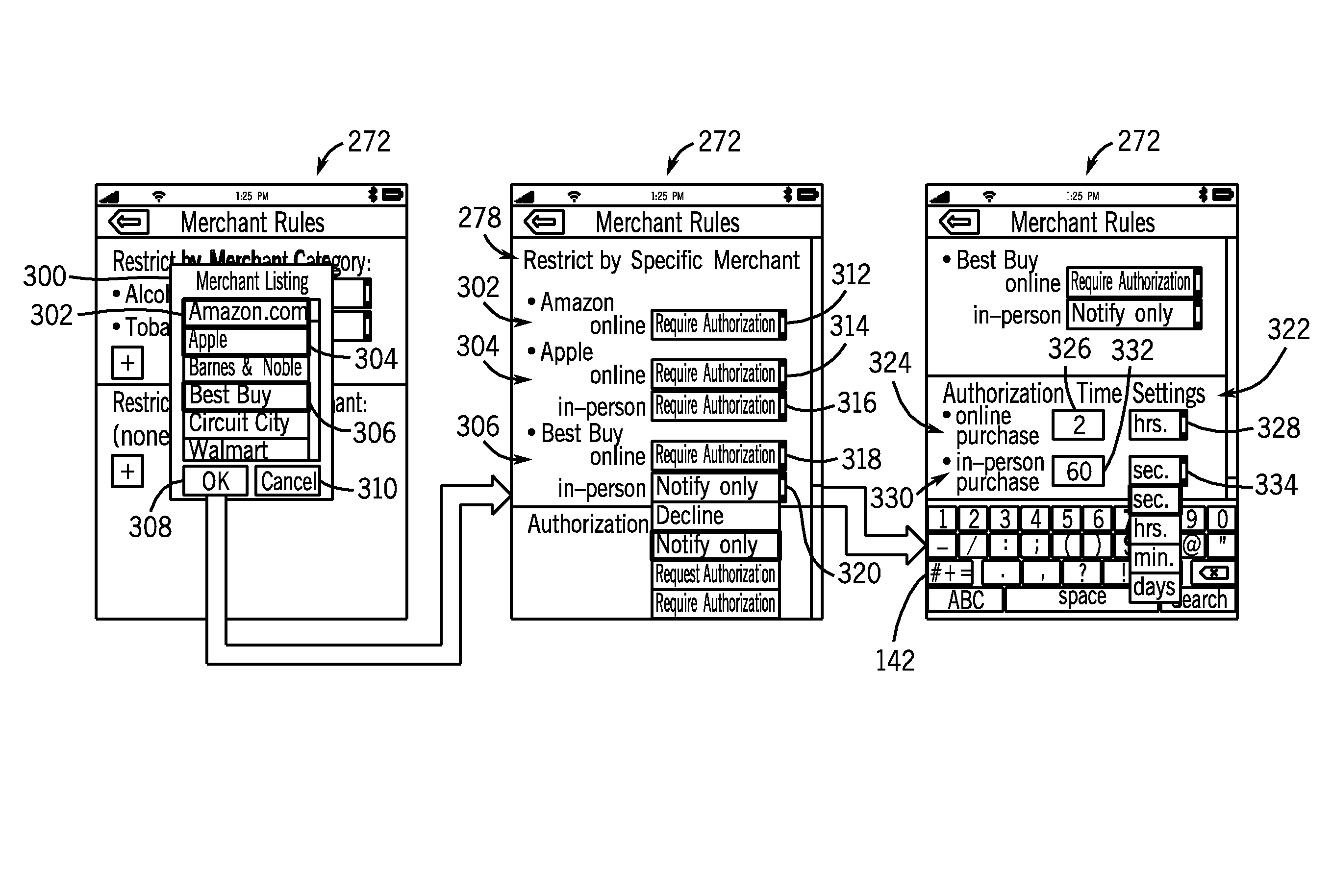

Parental controls

Various techniques are provided for establishing financial transaction rules to control one or more subsidiary financial accounts. In one embodiment, a financial account management application stored on a processor-based device may provide an interface for defining financial transaction rules to be applied to a subsidiary account. The financial transaction rules may be based upon transaction amounts, aggregate spending amounts over a period, merchant categories, specific merchants, geographic locations, or the like. The device may update the financial transaction rules associated with a subsidiary account by communicating the rules to an appropriate financial server. Accordingly, transactions made using the subsidiary account by a subsidiary account holder may be evaluated against the defined rules, wherein an appropriate control action is carried out if a financial transaction rule is violated.

Owner:APPLE INC

Group peer-to-peer financial transactions

Various techniques are provided for carrying out peer-to-peer financial transactions using one or more electronic devices. In one embodiment, a request for payment is transmitted from a first device to a second device using a near field communication (NFC) interface. In response to the request, the second device may transmit payment information to the first device. The first device may select a crediting account and, using a suitable communication protocol, may communicate the received payment information and selected crediting account to one or more external financial servers configured to process and determine whether the payment may be authorized. If the payment is authorized, a payment may be credited to the selected crediting account. In a further embodiment, a device may include a camera configured to obtain an image of a payment instrument. The device may further include an application to extract payment information from the acquired image.

Owner:APPLE INC

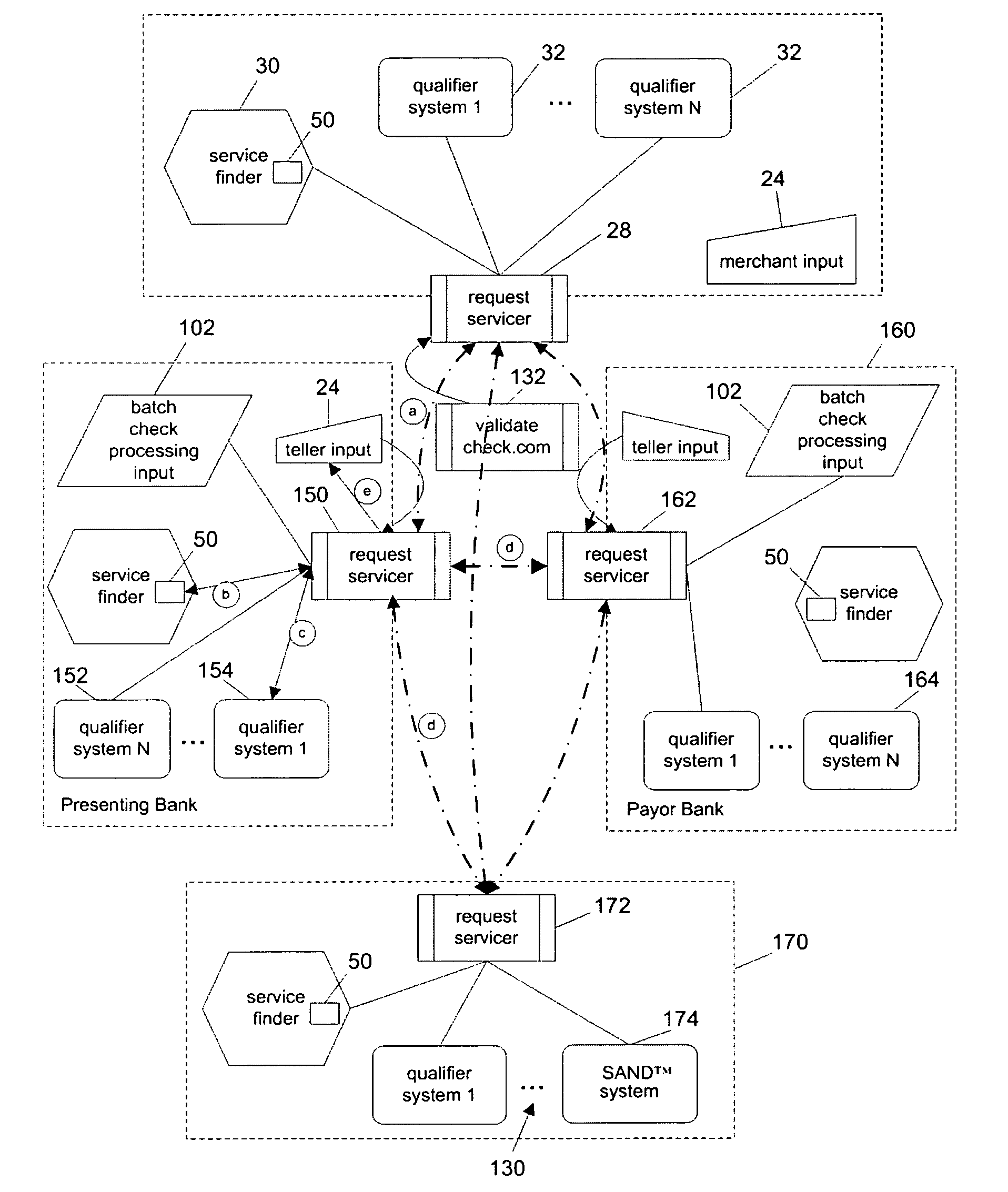

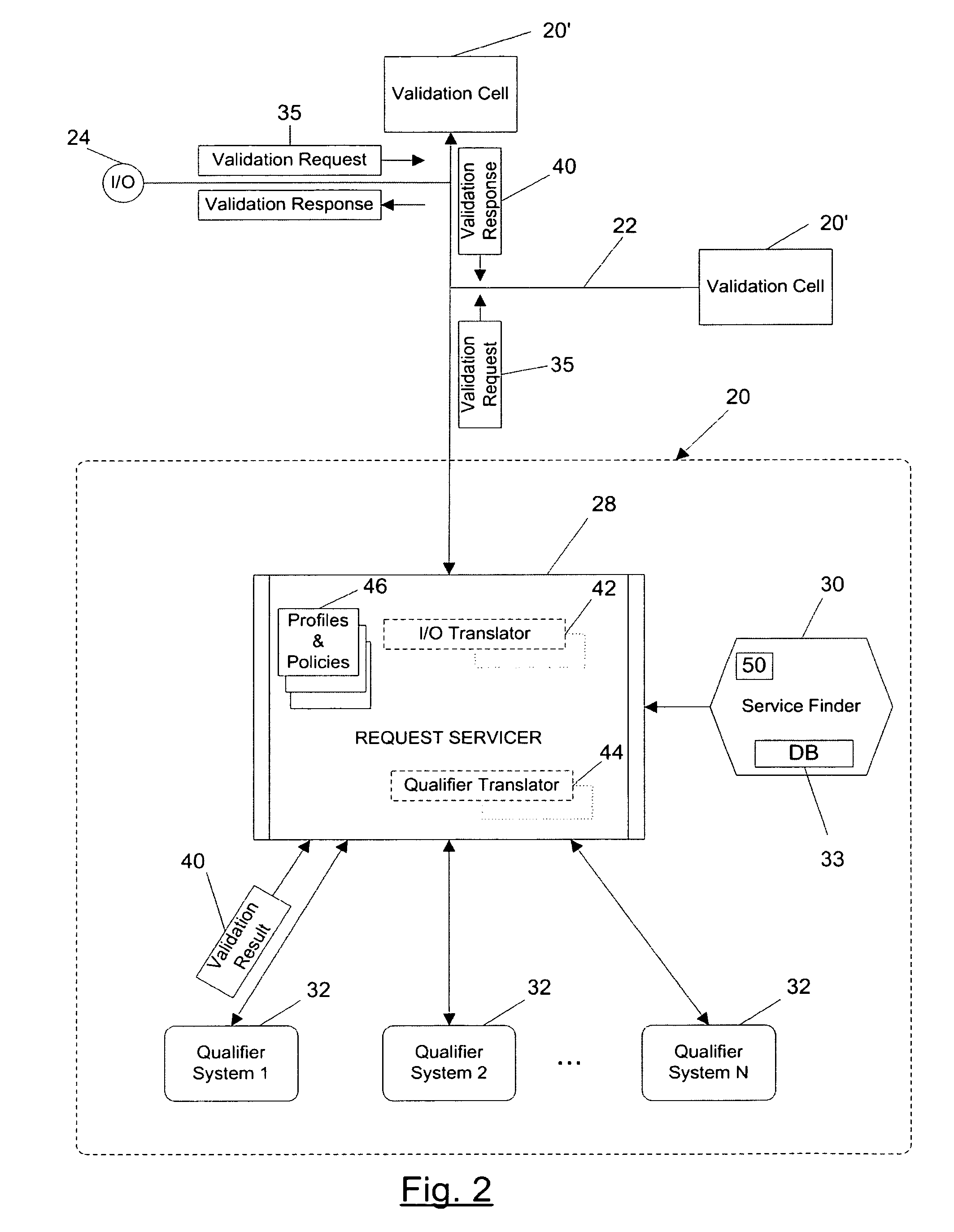

Payment validation network

ActiveUS7004382B2Easy to analyzeReduce riskComplete banking machinesSpecial service provision for substationPaymentTransaction data

A payment validation network having network of payment validation cells, each of which includes: one or more local qualifier systems for assessing the risk of loss in accepting a check; a service finder for identifying the scope of coverage provided by each of the local qualifier systems and for identifying the scope of coverage provided by other cells; and one or more input / output (I / O) sources for obtaining transaction data associated with a check at a point of presentment. The request servicer interfaces with the I / O sources, service finder and the qualifier systems in order to (i) receive transaction data from an I / O source in connection with the check, including the routing / transit number, (ii) maintain a user profile for the I / O source, (iii) consult the service finder to identify which local qualifier systems cover the routing / transit (R / T) number associated with the check, (iv) transmit a payment validation request to the identified local qualifier systems and at least one other remote request servicer in accordance with the user profile, (v) receive one or more validation results from local qualifier systems or remote request servicers, and (vi) process said results to provide a homogeneous validation assessment to the requesting I / O source.

Owner:ADVANCED SOFTWARE DESIGN

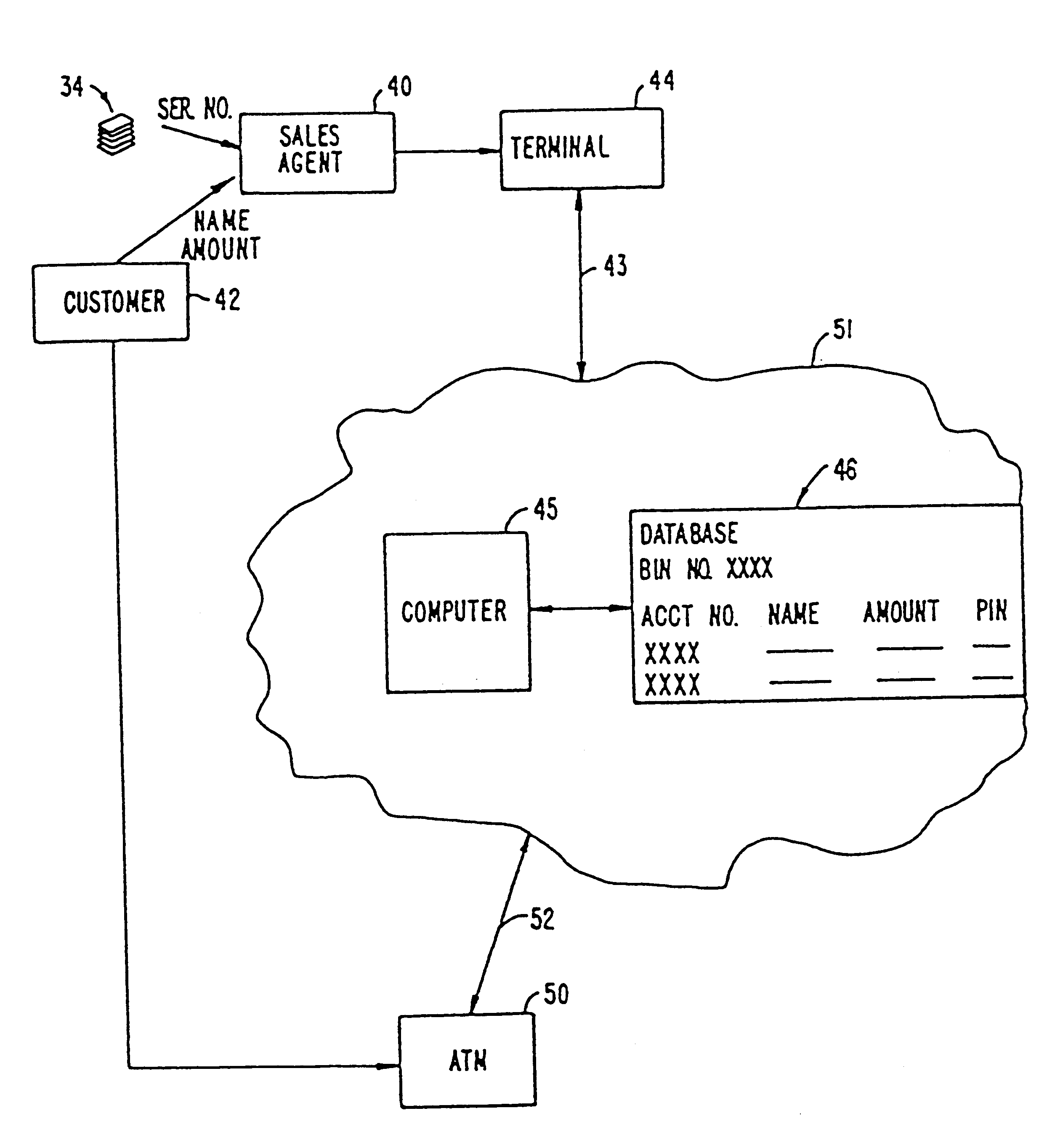

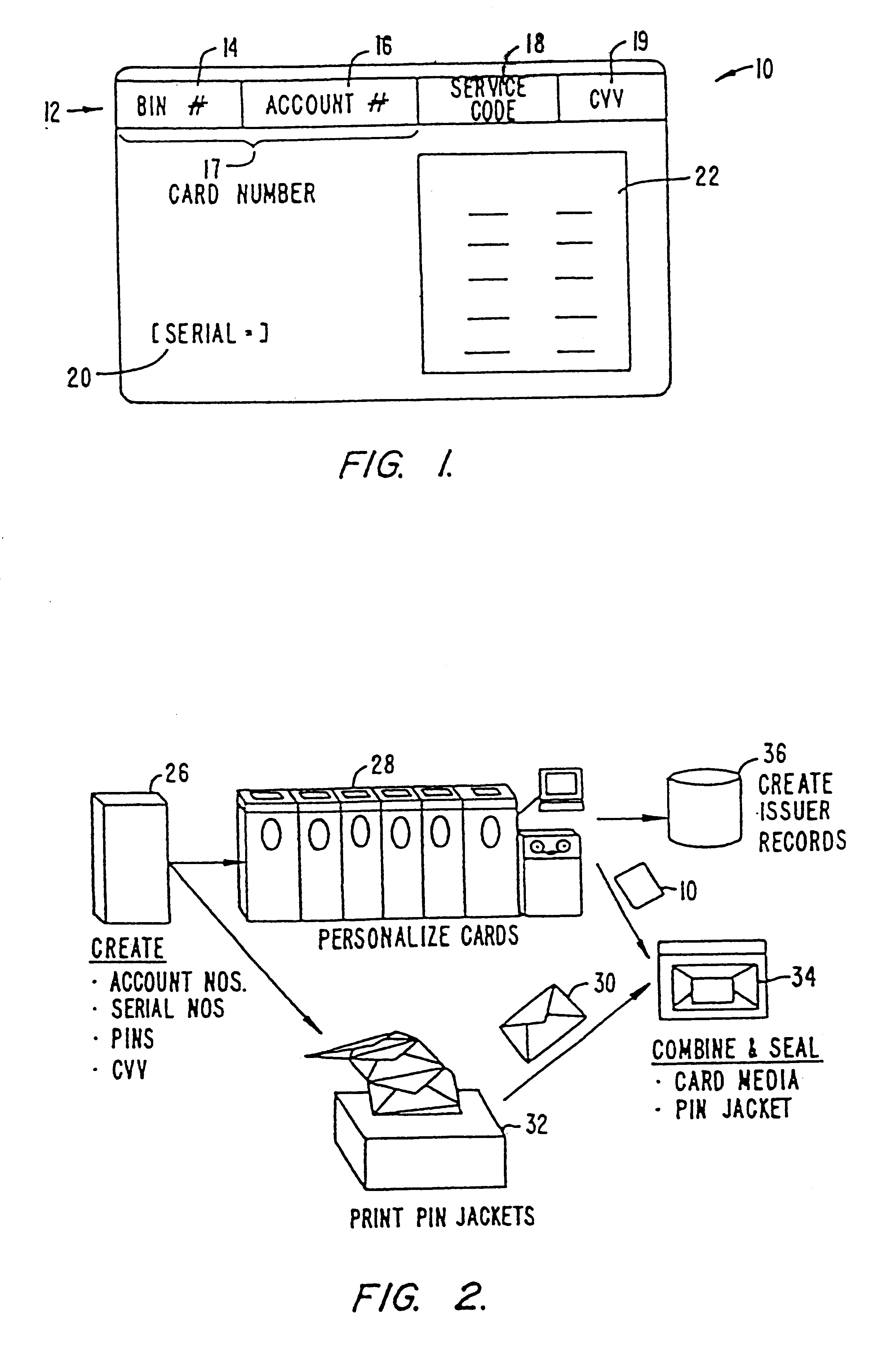

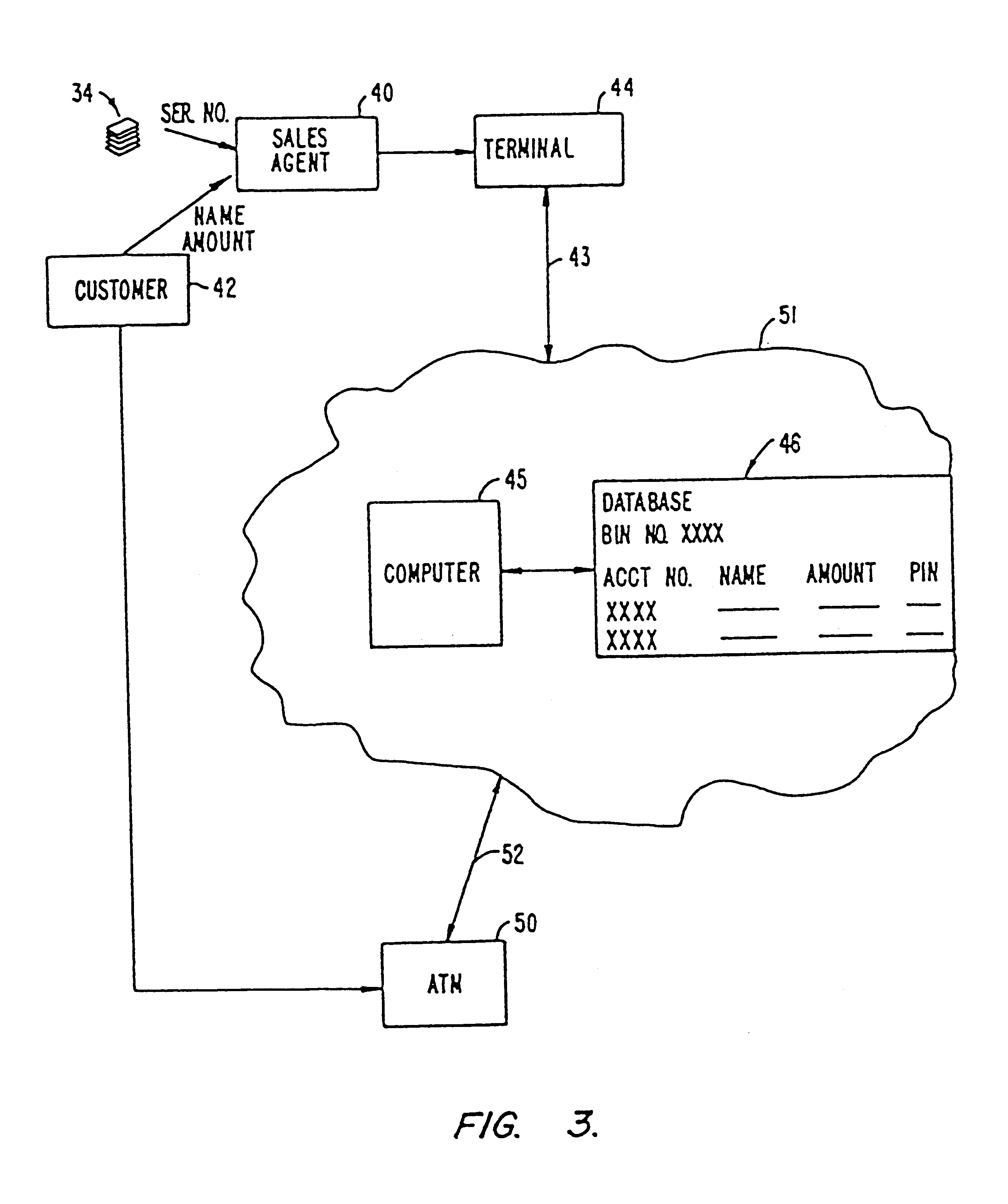

Method and apparatus for distributing currency

InactiveUSRE37122E1Improve securityComplete banking machinesCredit registering devices actuationElectronic accessComputer terminal

A process which provides electronic access to pre-paid funds for cash or payment for goods and services. A card is issued to a customer with a value selectable by the customer. The card has a magnetic stripe with an encoded card number including a bank identification number (BIN) and an account number. The central card processor establishes a zero balance database including the card numbers, but with blank fields for the customer data and the value of the account. When a customer purchases a card, the sales agent transmits to the central database computer which fills in the blanks in the database, activating the account, and transmits an acknowledgement signal back to the sales agent. The customer can immediately use the card in ATM or other remote terminals to acquire cash or purchase goods and services. The customer inputs a PIN number which is provided with the card, or a customer selected alternative PIN number.

Owner:VISA INT SERVICE ASSOC

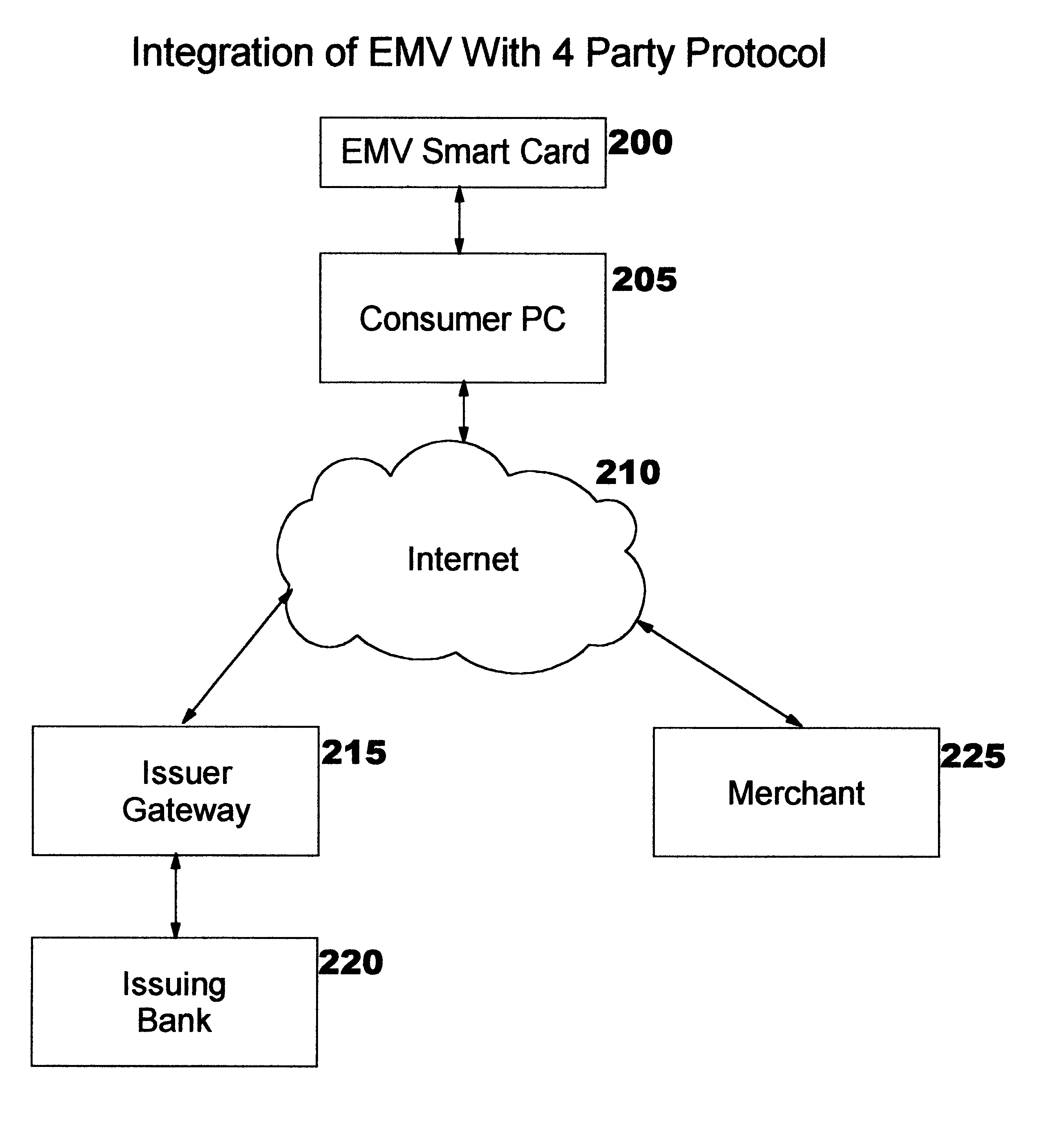

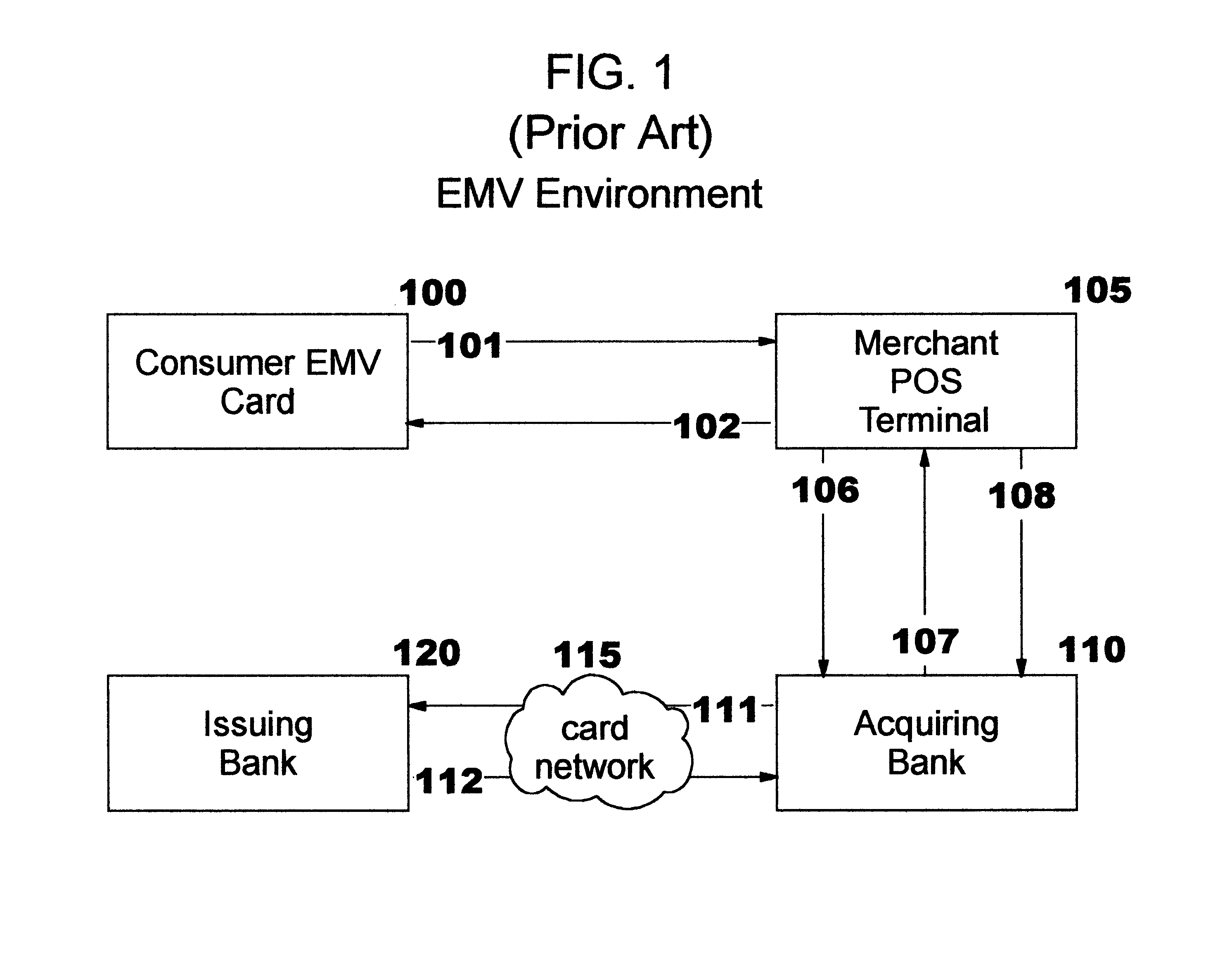

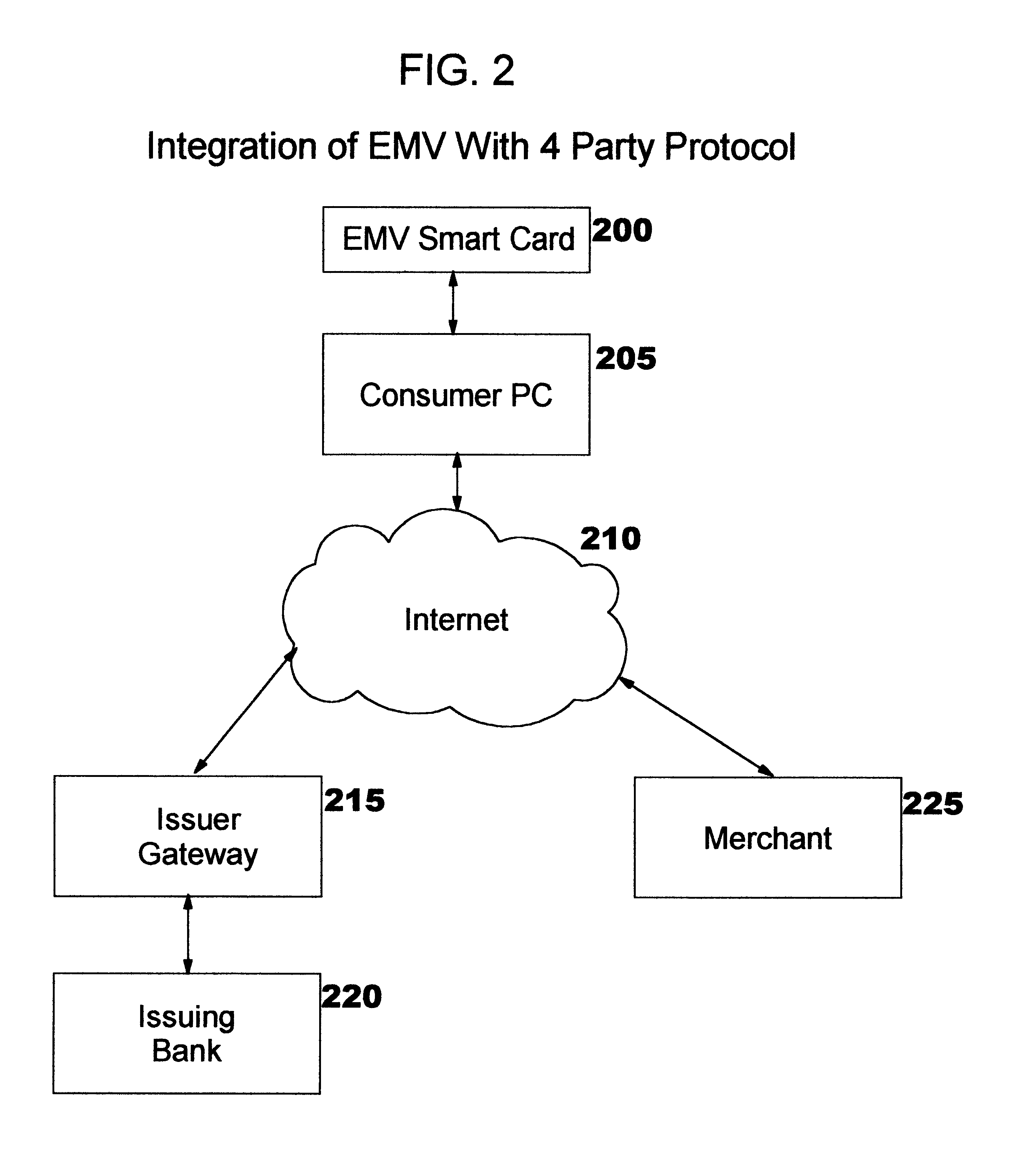

Enabling use of smart cards by consumer devices for internet commerce

A method, system, and computer readable code for enabling use of smart cards by consumer devices for Internet commerce. This is achieved by integrating an existing “Integrated Circuit Card Specification for Application Payment Systems” standard (commonly known as the “EMV” standard) with an augmented version of the Four-Party Credit / Debit Payment Protocol which was disclosed in U.S. Pat. No. 6,327,578. The result of the integration allows a consumer to use a smart card from a personal computer system for credit or debit transactions, while preserving the level of security and other features required by the credit card associations and banks. No modifications are required to the existing EMV standard or existing EMV smart cards.

Owner:IBM CORP

Onetime passwords for smart chip cards

ActiveUS20090200371A1Unauthorised/fraudulent call preventionEavesdropping prevention circuitsDisplay deviceFinancial transaction

A financial transaction card is provided according to various embodiments described herein. The financial transaction card includes a card body with at least a front surface and a back surface. The financial transaction card may also include a near field communications transponder and / or a magnetic stripe, as well as a digital display configured to display alphanumeric characters on the front surface of the card body. The financial transaction card may also include a processor that is communicatively coupled with the near field communications transponder or magnetic stripe and the digital display. The processor may be configured to calculate one-time passwords and communicate the one-time passwords to both the near filed communications transponder or magnetic stripe and the digital display.

Owner:FIRST DATA

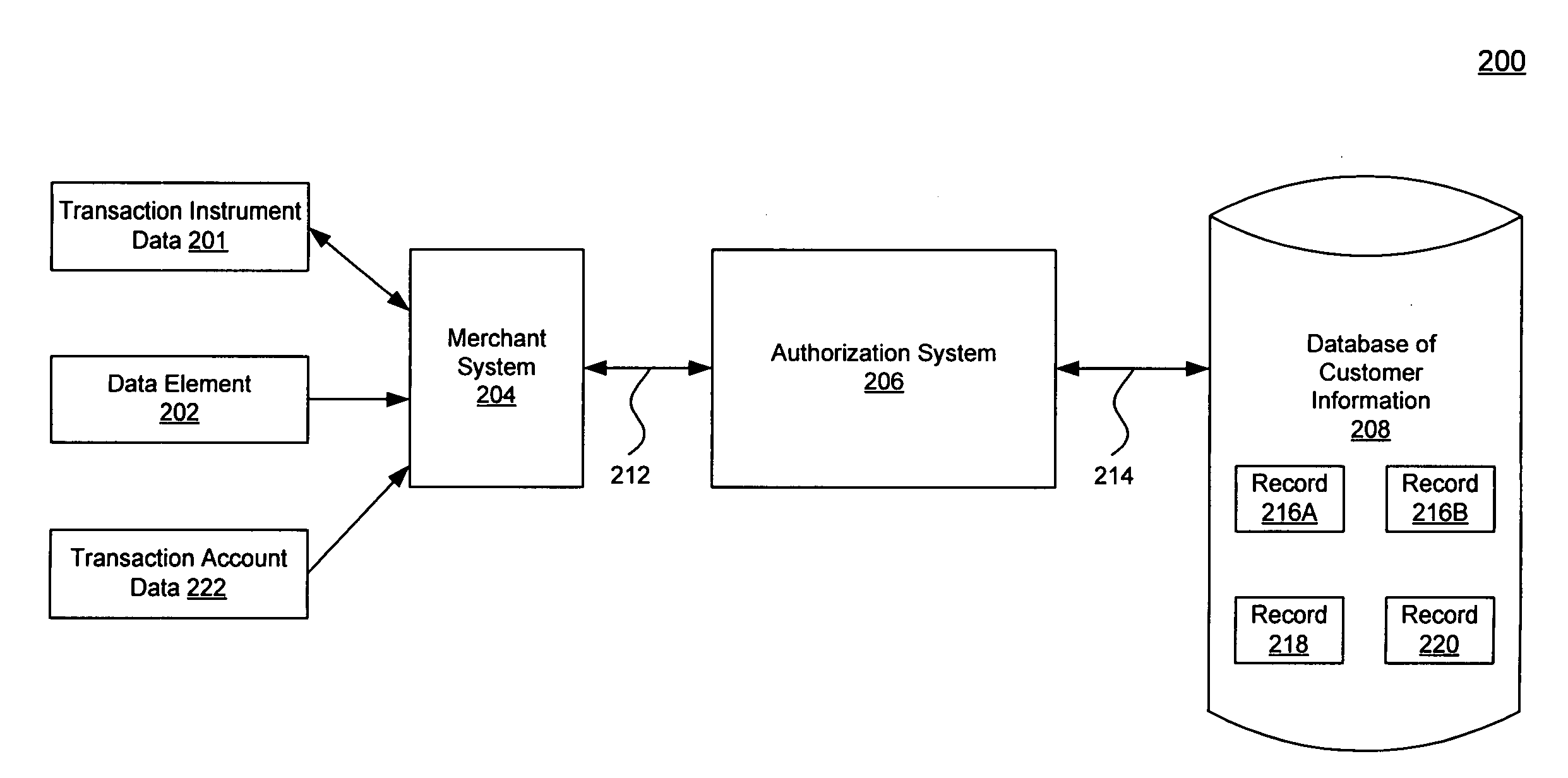

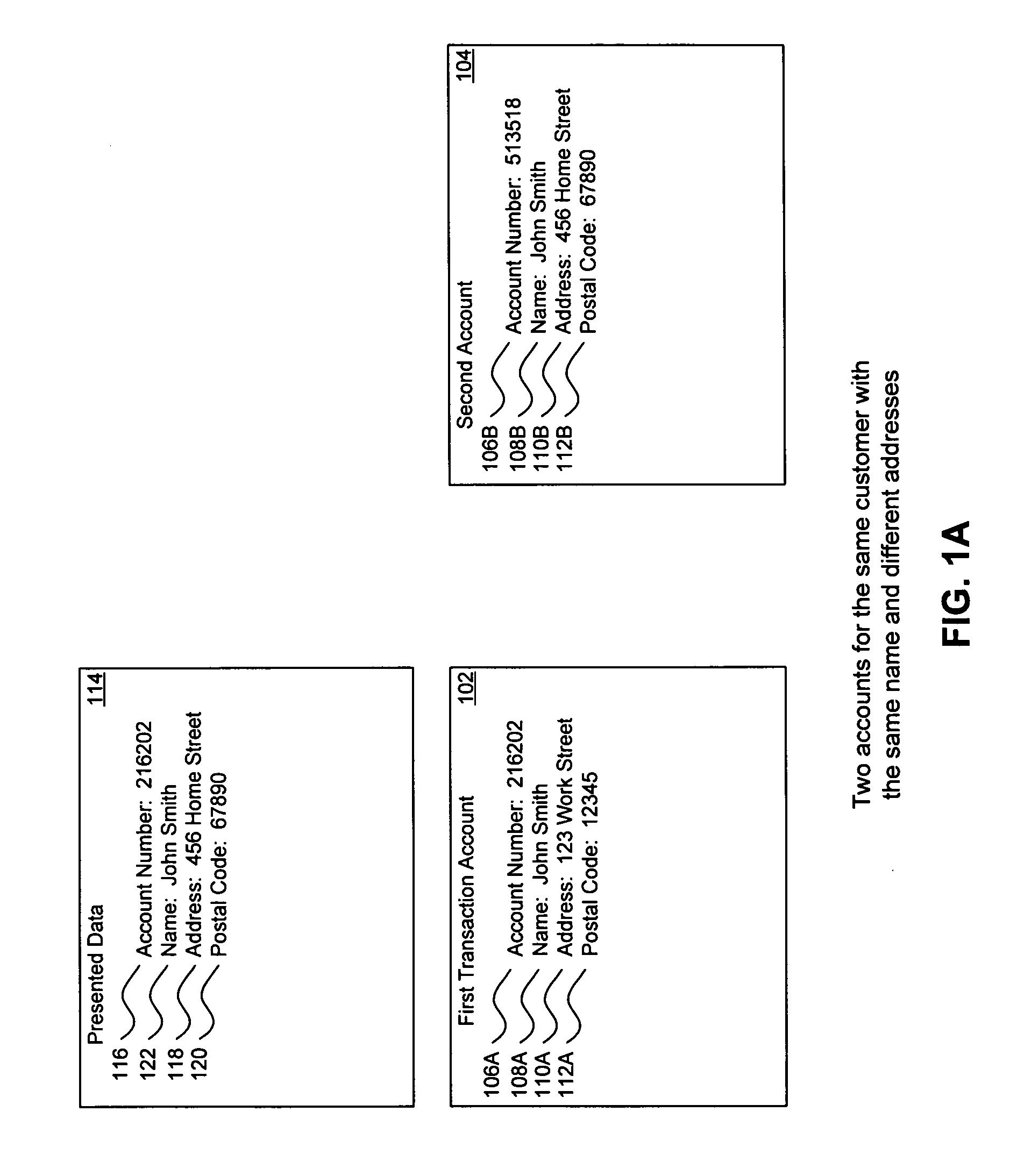

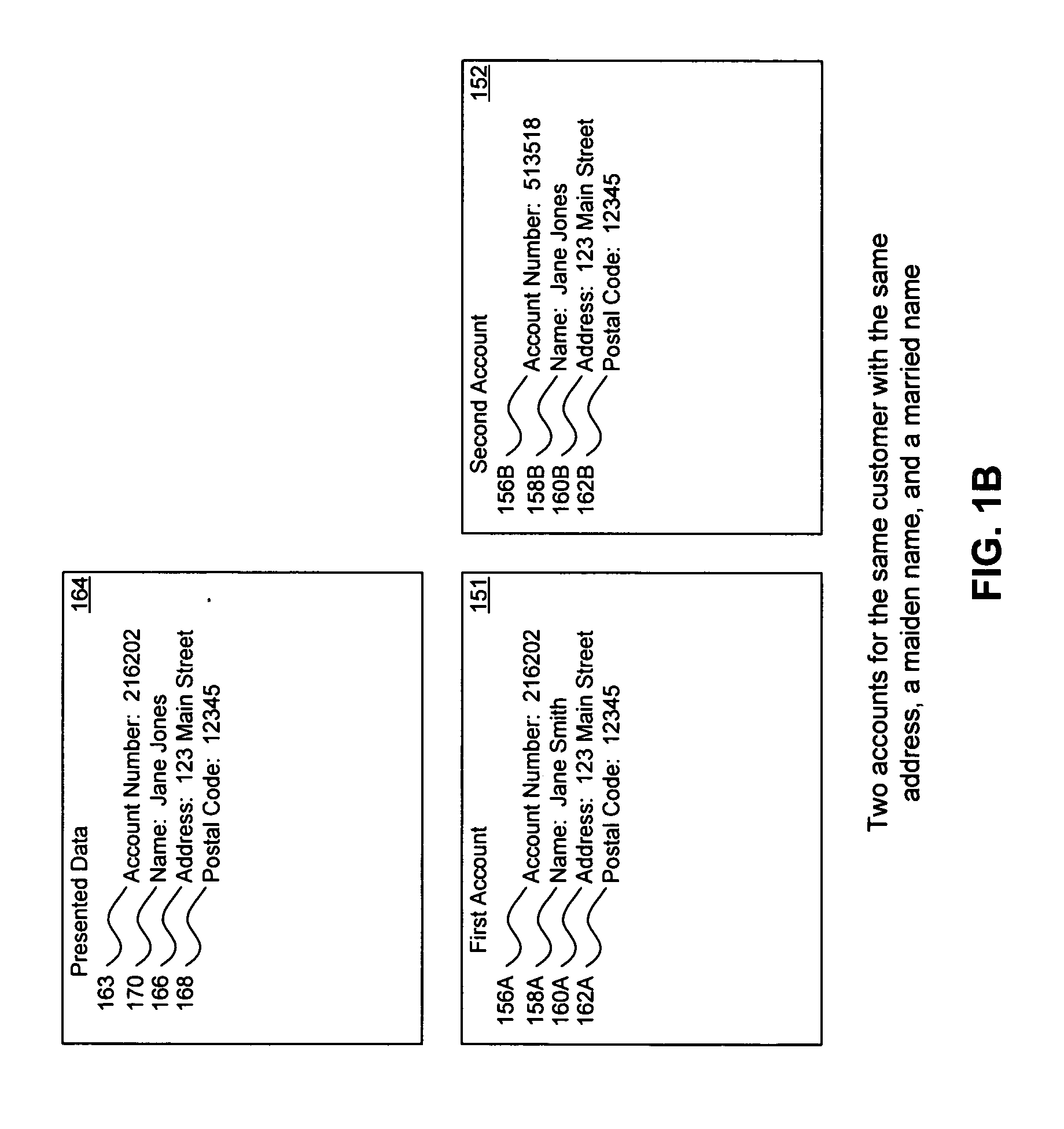

Method, system, and computer program product for customer-level data verification

ActiveUS20070284433A1Improve accuracyReduce error rateComplete banking machinesFinanceData validationSource Data Verification

A system, method, and computer program to reduce incorrectly declined transactions and improve risk calculation accuracy by reducing error probability during fraud detection. The tool first receives at least one data element as well as transaction account data and / or financial transaction instrument data. Then a customer is determined from a first record associated with the transaction account data and / or financial transaction instrument data. A record search is performed to identify at least one additional record associated with the customer. Finally, the data element is compared to the information contained in the additional record to create a comparison result that verifies a customer address. The comparison result may be used as an input to transaction risk calculations. The comparison result may also be provided to a merchant system and / or merchant for use in a decision-making process, for example, to verify customer identity.

Owner:LIBERTY PEAK VENTURES LLC

System and method for performing money transfer transaction using TCP/IP

InactiveUS6502747B1Low costShorten the timeComplete banking machinesFinanceInternet protocol suiteProtocol for Carrying Authentication for Network Access

A method of performing a money transfer transaction through a financial services institution includes receiving information regarding the transaction on a first computer of the financial services institution from a first electronic device using the Transmission Control Protocol / Internet Protocol suite (TCP / IP). The method may also include establishing a T1 connection between the first computer and the first electronic device. A system for performing a money transfer transaction using TCP / IP is also disclosed.

Owner:THE WESTERN UNION CO

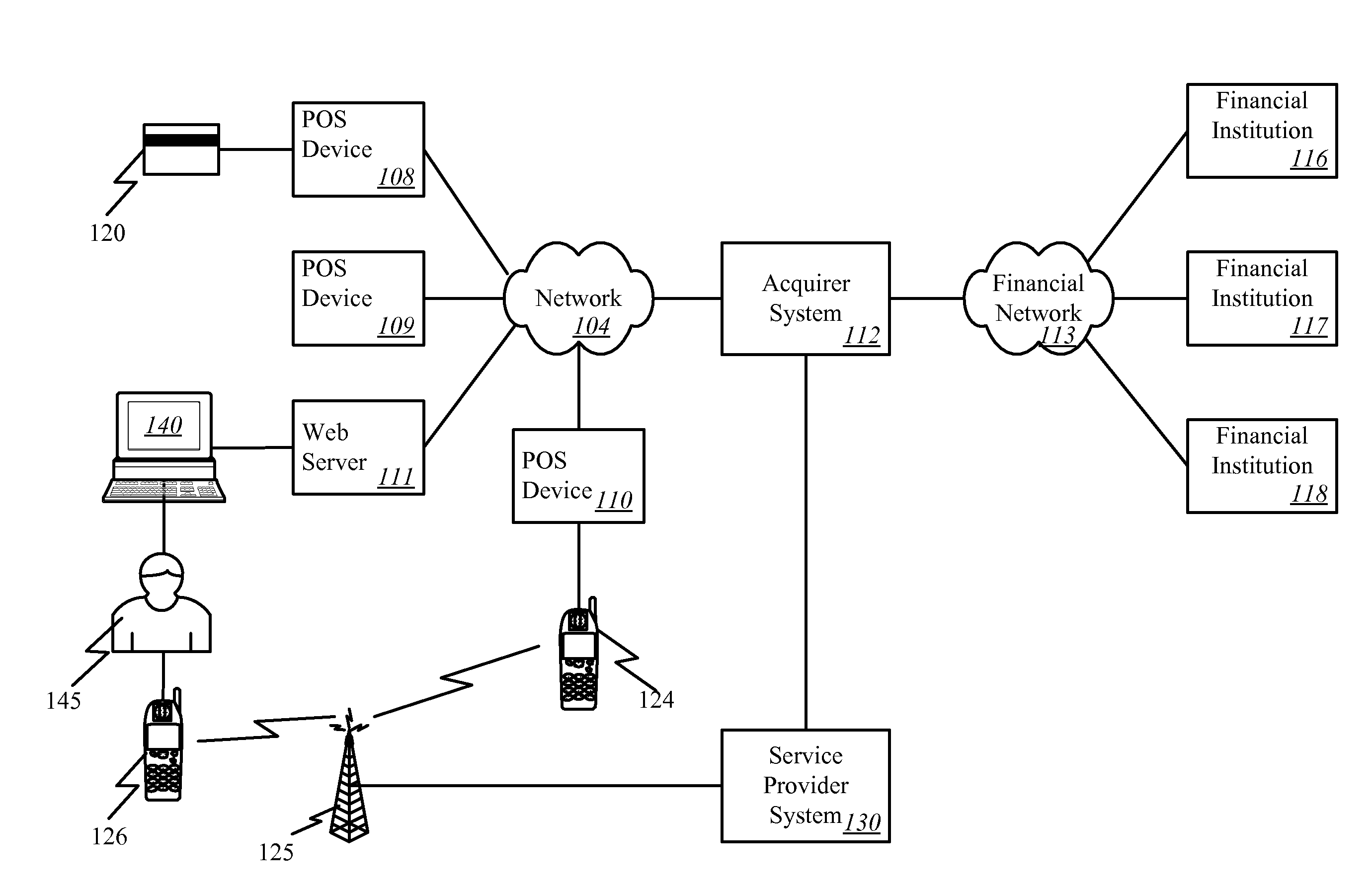

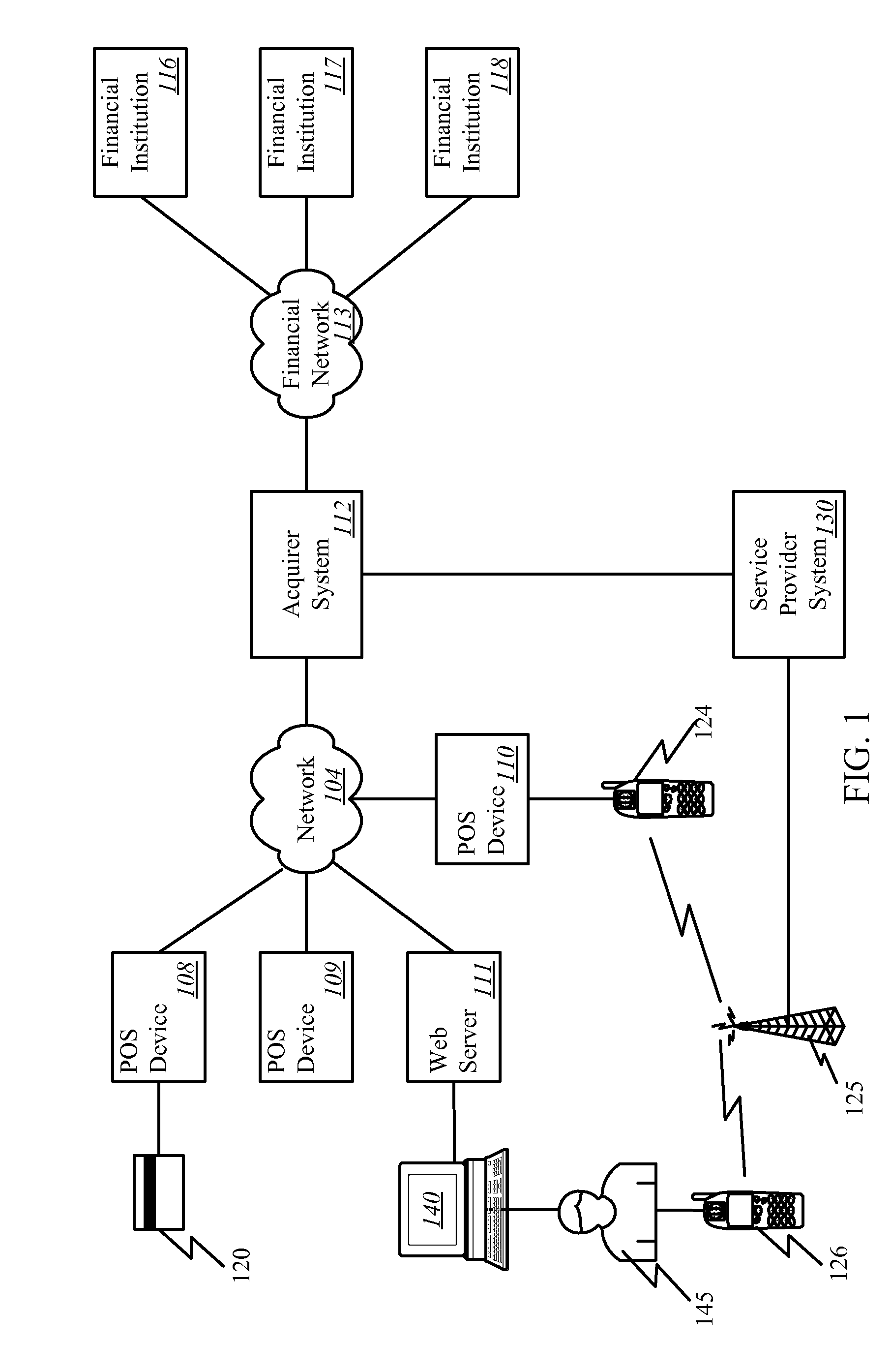

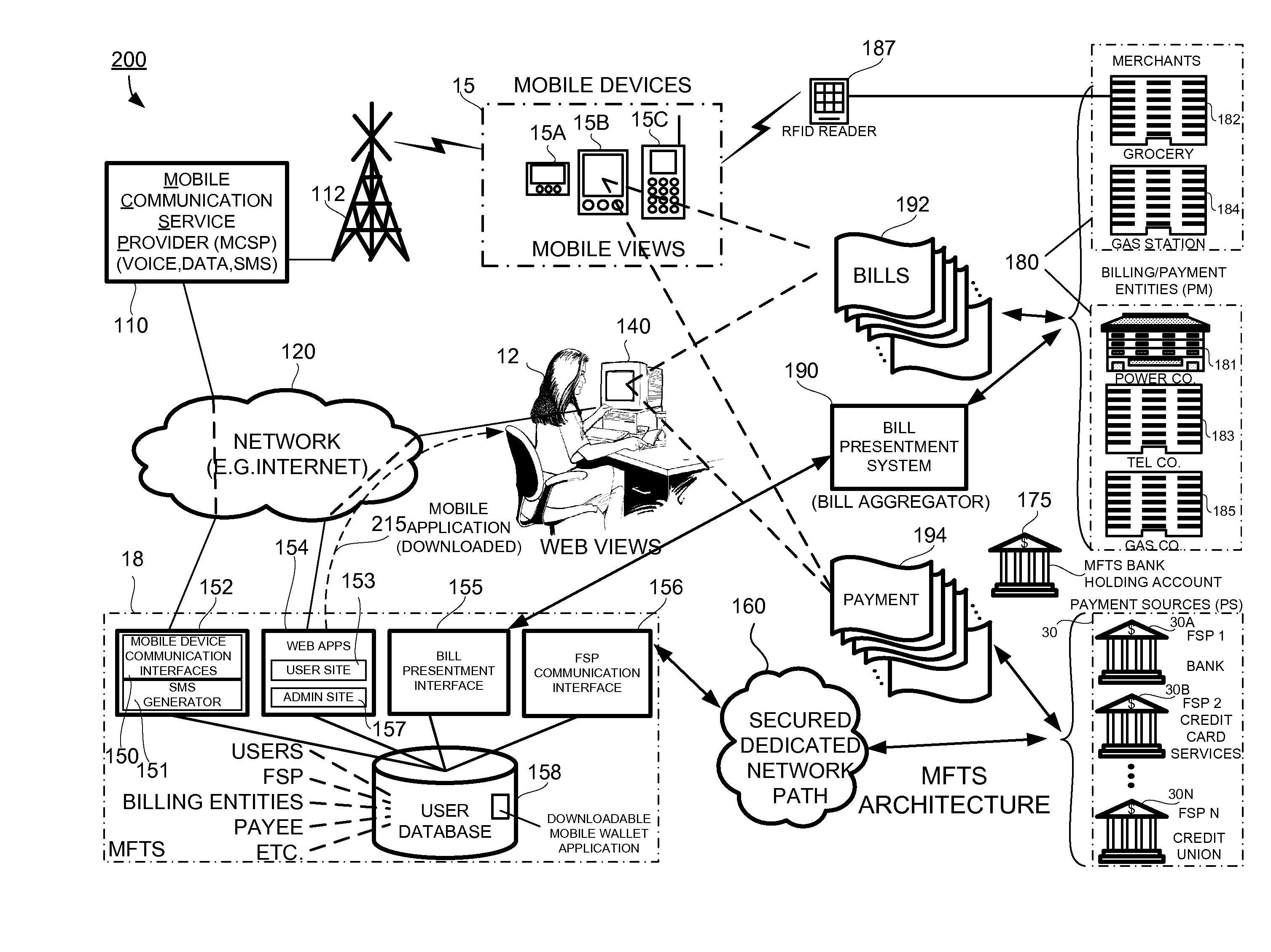

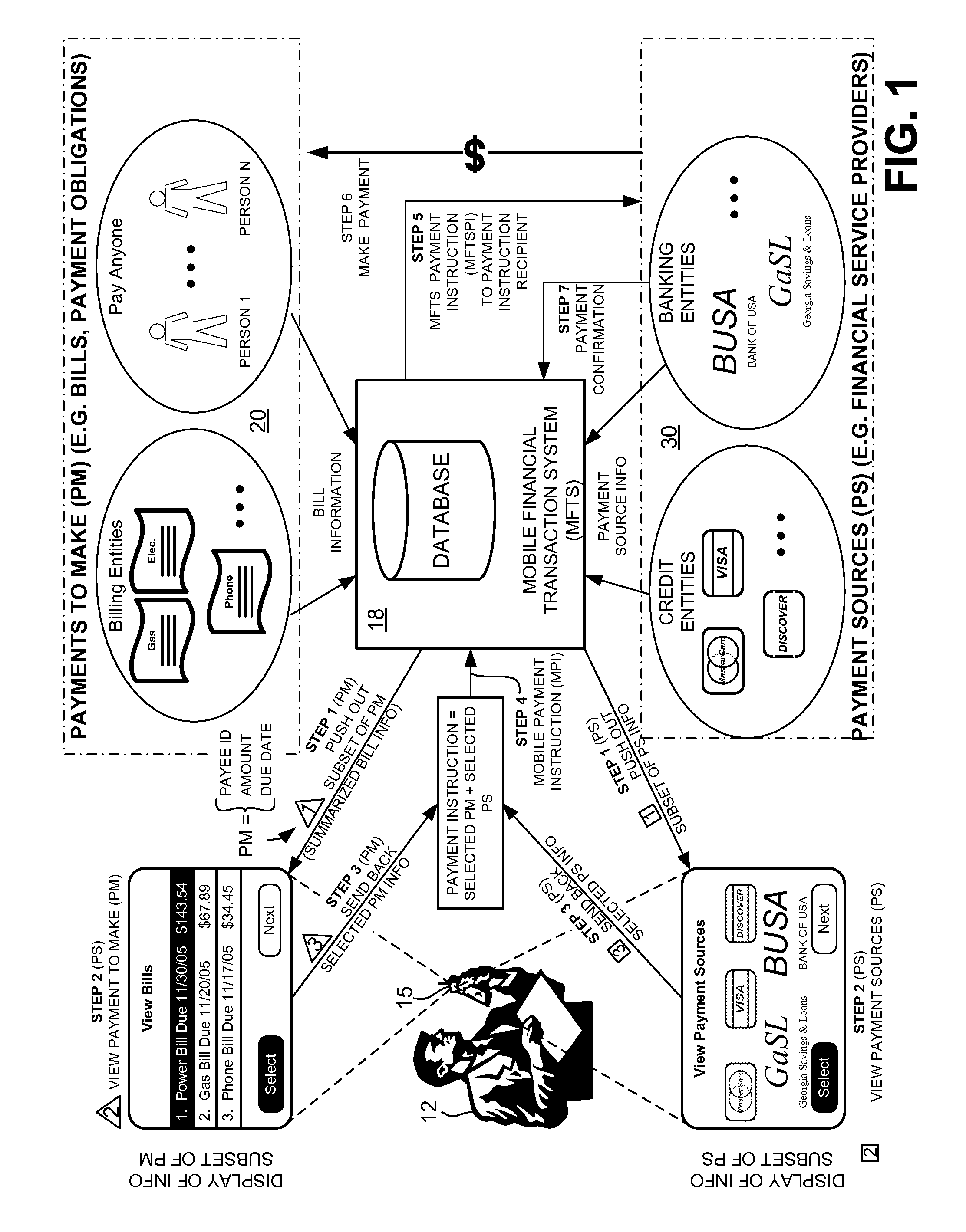

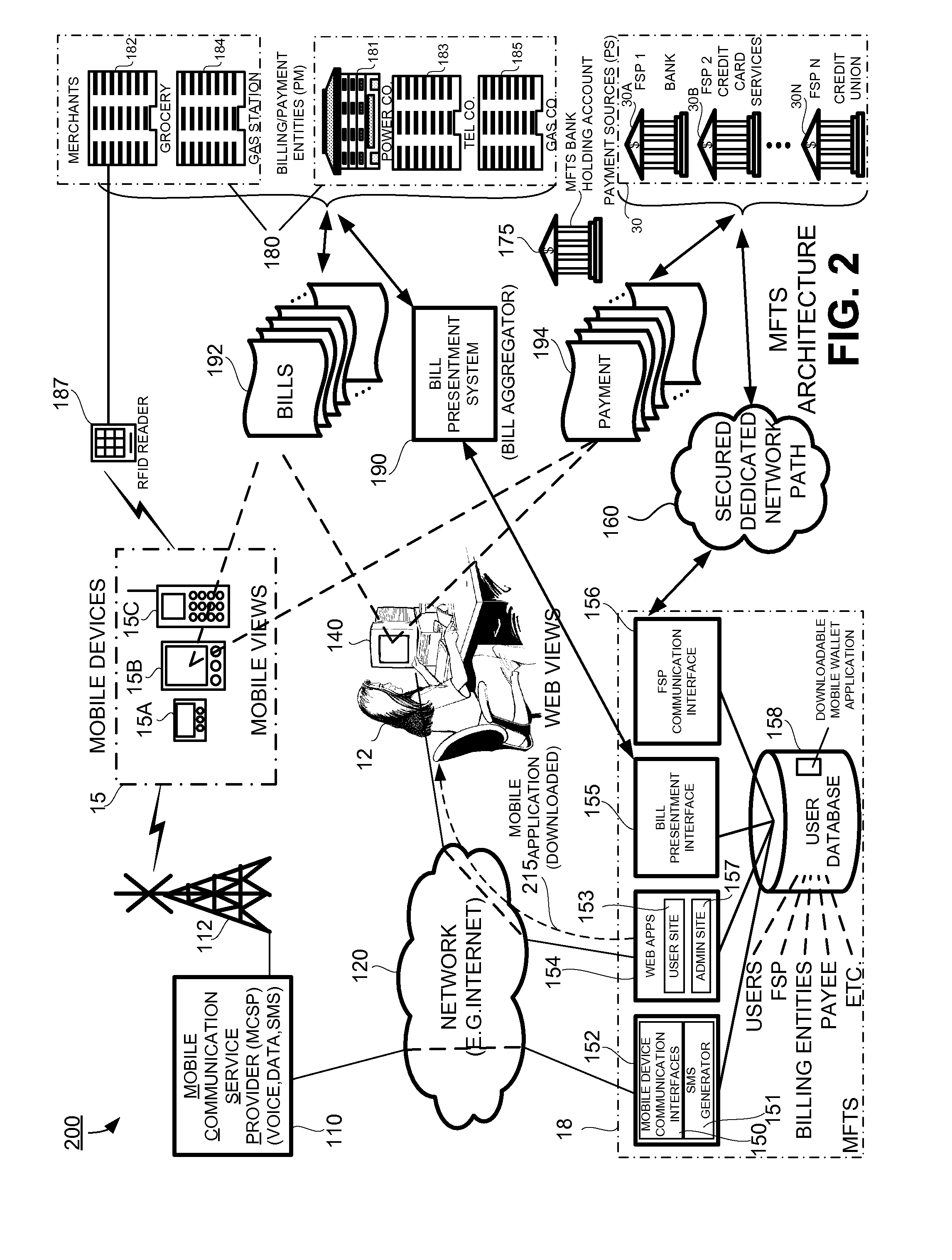

Methods and Systems For Real Time Account Balances in a Mobile Environment

InactiveUS20080006685A1Unprecedented convenienceUnprecedented flexibilityComplete banking machinesFinanceElectronic communicationFinancial transaction

Methods and systems for obtaining real time account balance information for a plurality of financial accounts maintained at one or more financial service providers utilizing a mobile device such as a mobile telephone (cellphone) or wireless connected personal digital assistant (PDA). A mobile financial transaction system (MFTS) is coupled for wireless communications with a mobile device of a user and is also coupled for electronic communication with one or more financial service providers with which the user maintains one or more accounts. The mobile device stores a cached account balance representative of the balance in each account as of a particular date. The MFTS communicates with financial service providers to obtain updated account balance information for a user's accounts. The updated account balance information is wirelessly communicated to a user's mobile device. In response to receipt of updated account balance information from the MFTS, the mobile device displays updated account balance information corresponding to the plurality of user accounts.

Owner:QUALCOMM INC

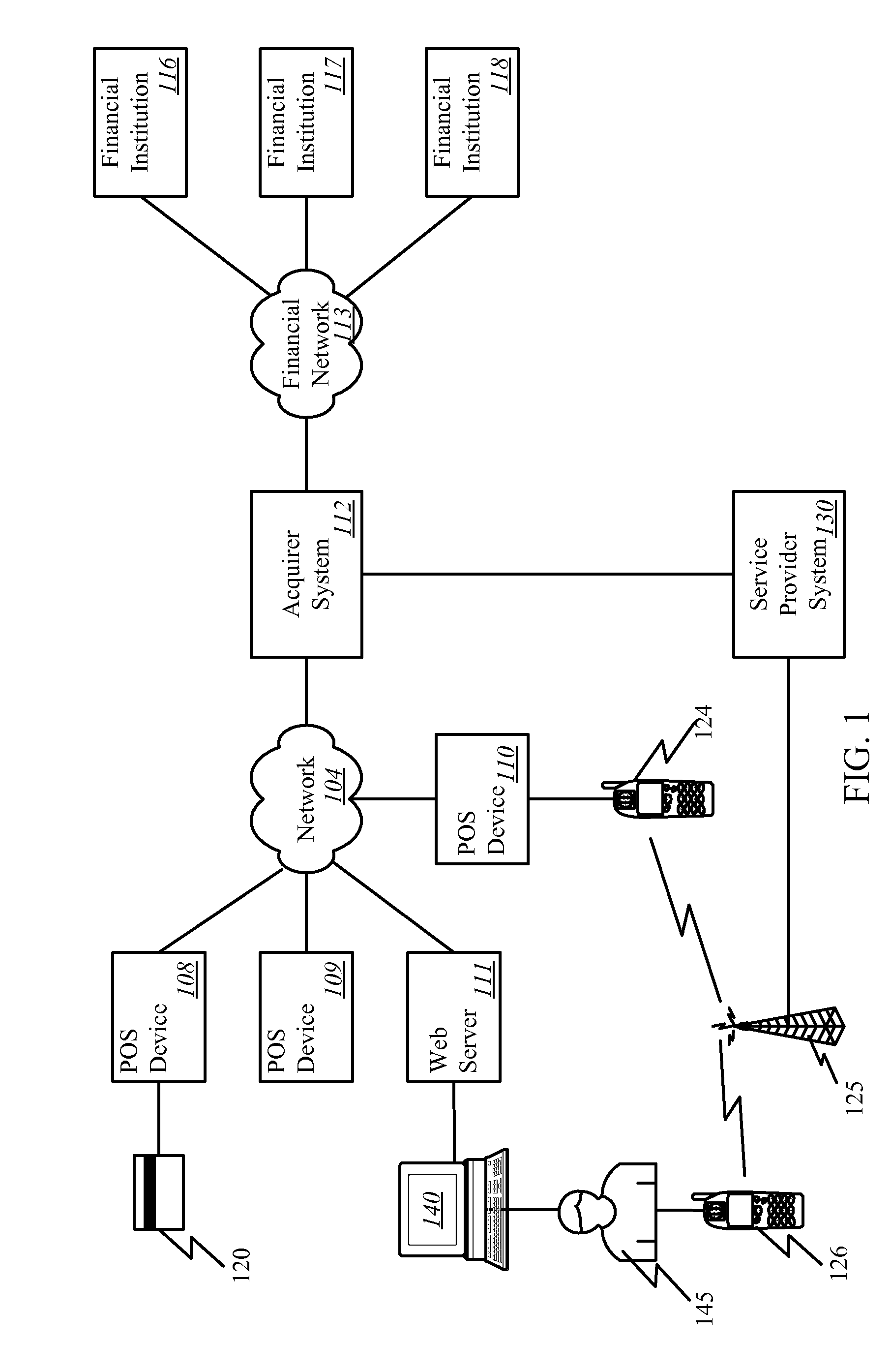

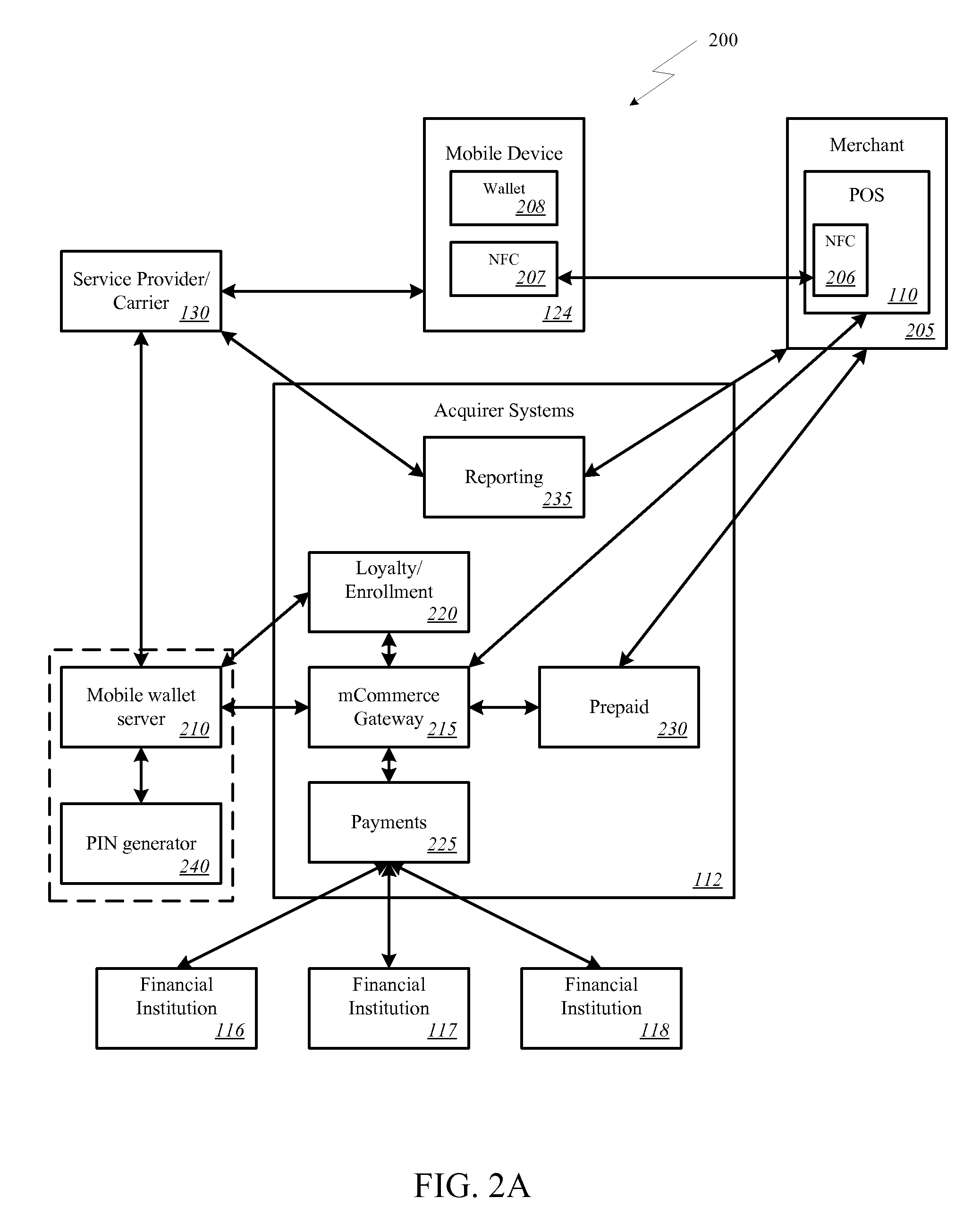

Collaborative negotiation techniques for mobile personal trusted device financial transactions

Techniques for negotiation techniques for mobile personal trusted device financial transactions are provided. A user of a mobile personal trusted device sets user preferences that define the user's preferred parameters for conducting financial transactions. A merchant sets merchant preferences that define the merchant's preferred parameters for conducting financial transactions. When a financial transaction is initiated, a user preference and a merchant preferences are accessed. A negotiated preference is generated that accommodates both the user preference and the merchant preference. If the user preference and the merchant preference are not mutually exclusive, the negotiated preference attempts to satisfy both preferences. If the user preference and the merchant preference are mutually exclusive, the negotiated preference satisfies at least one of the two preferences based on which of the two preferences has a higher priority. The financial transaction is conducted based on the negotiated preference.

Owner:MASTERCARD INT INC

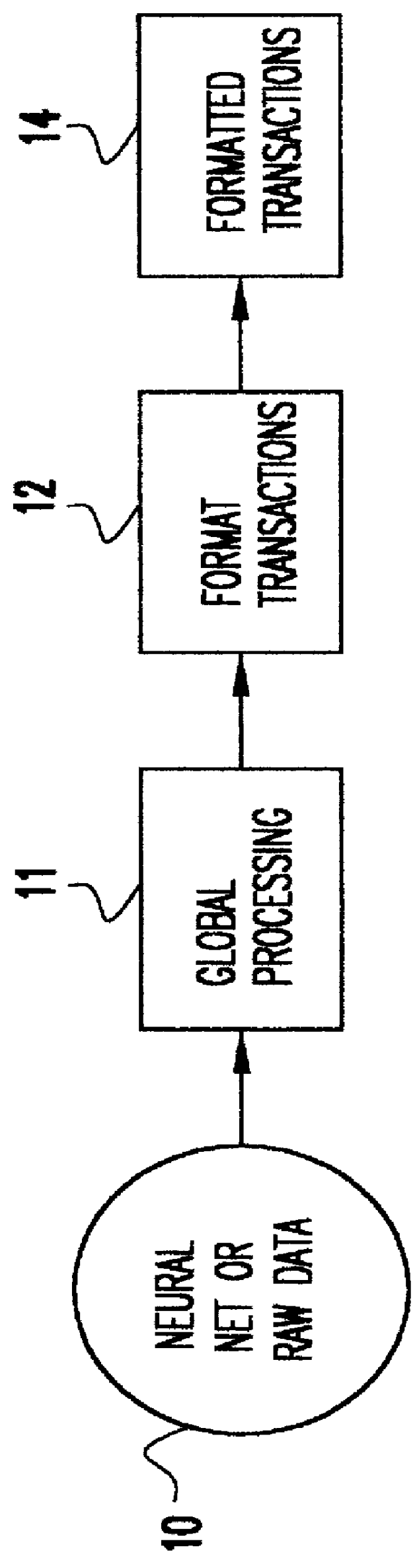

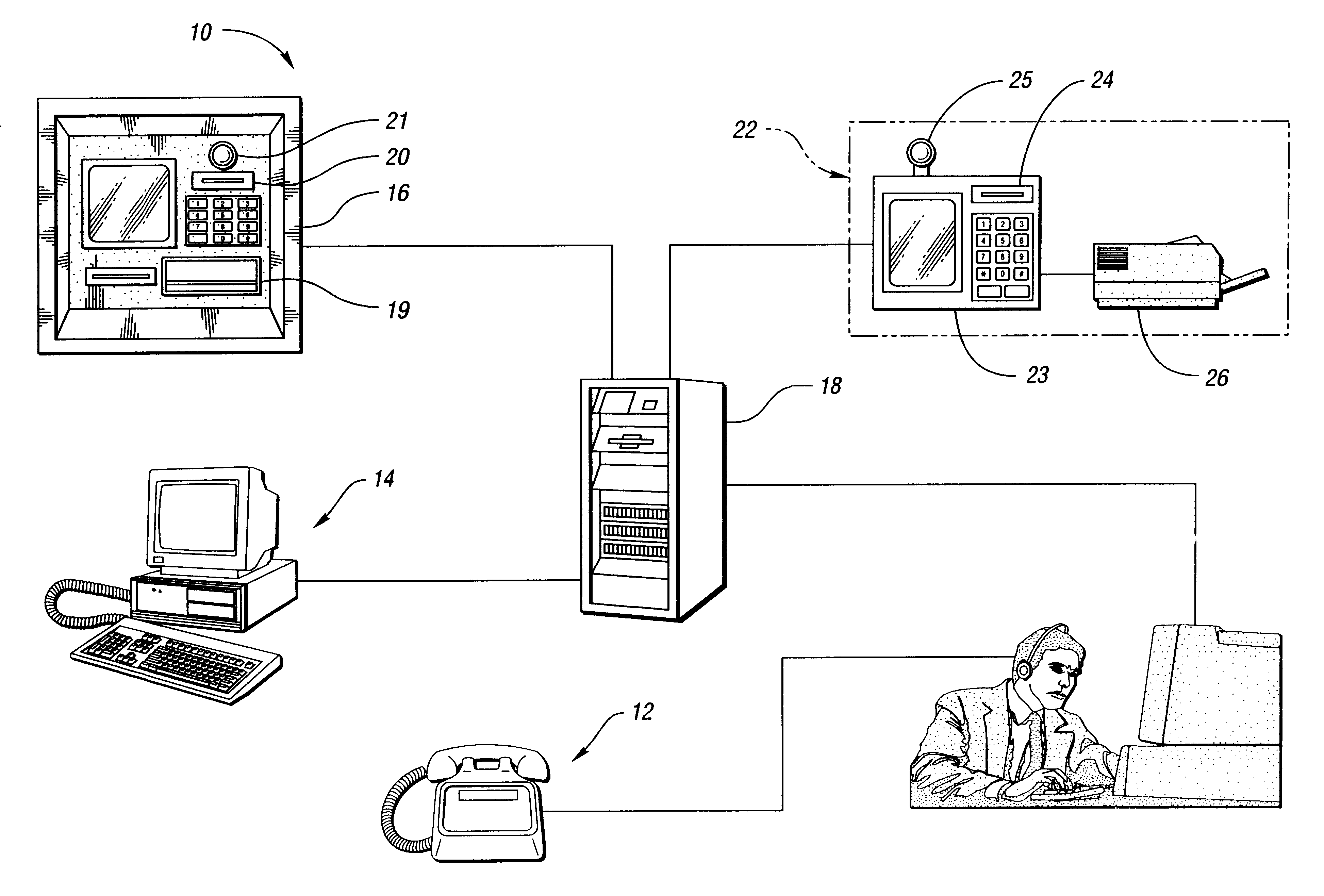

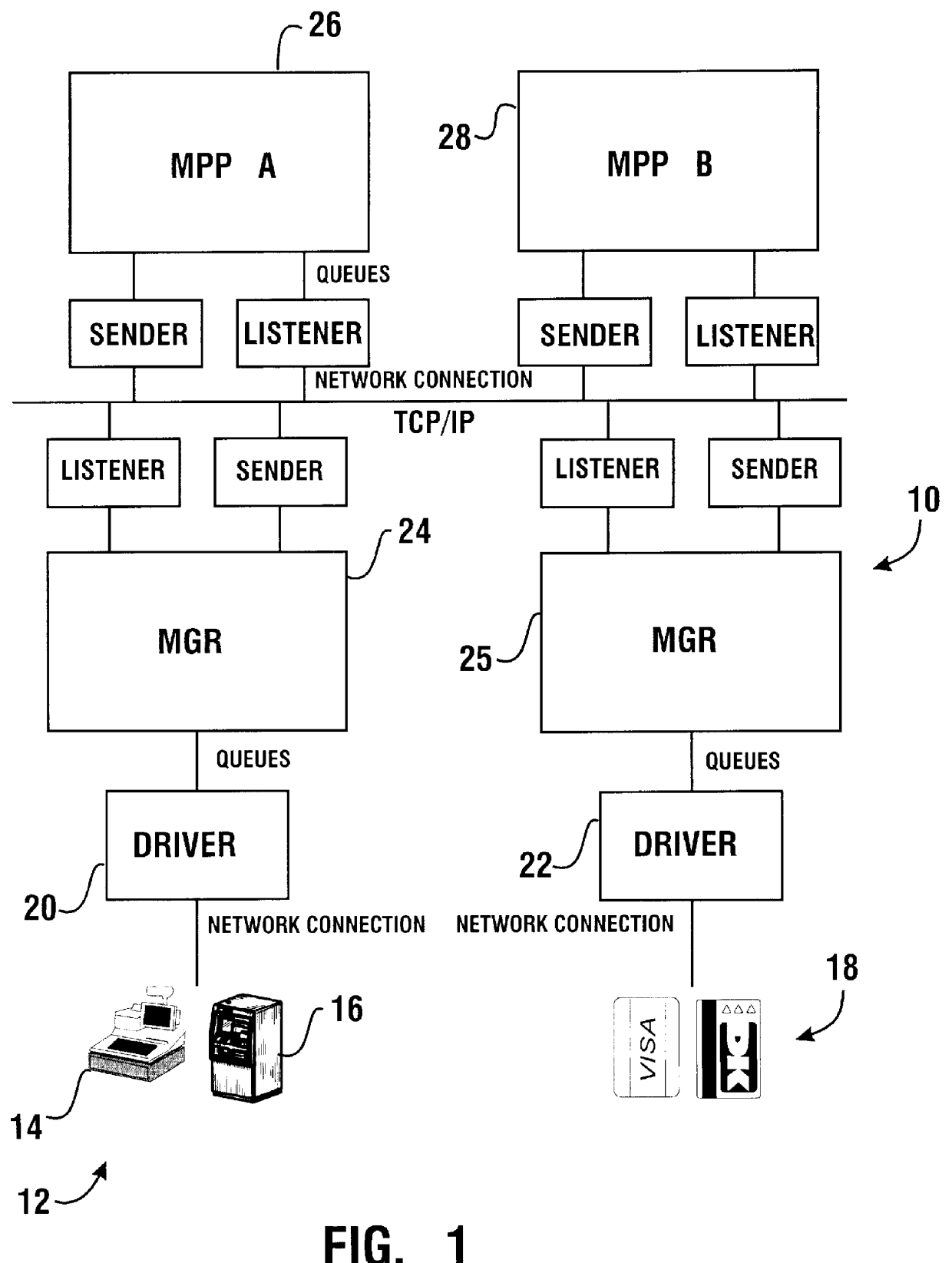

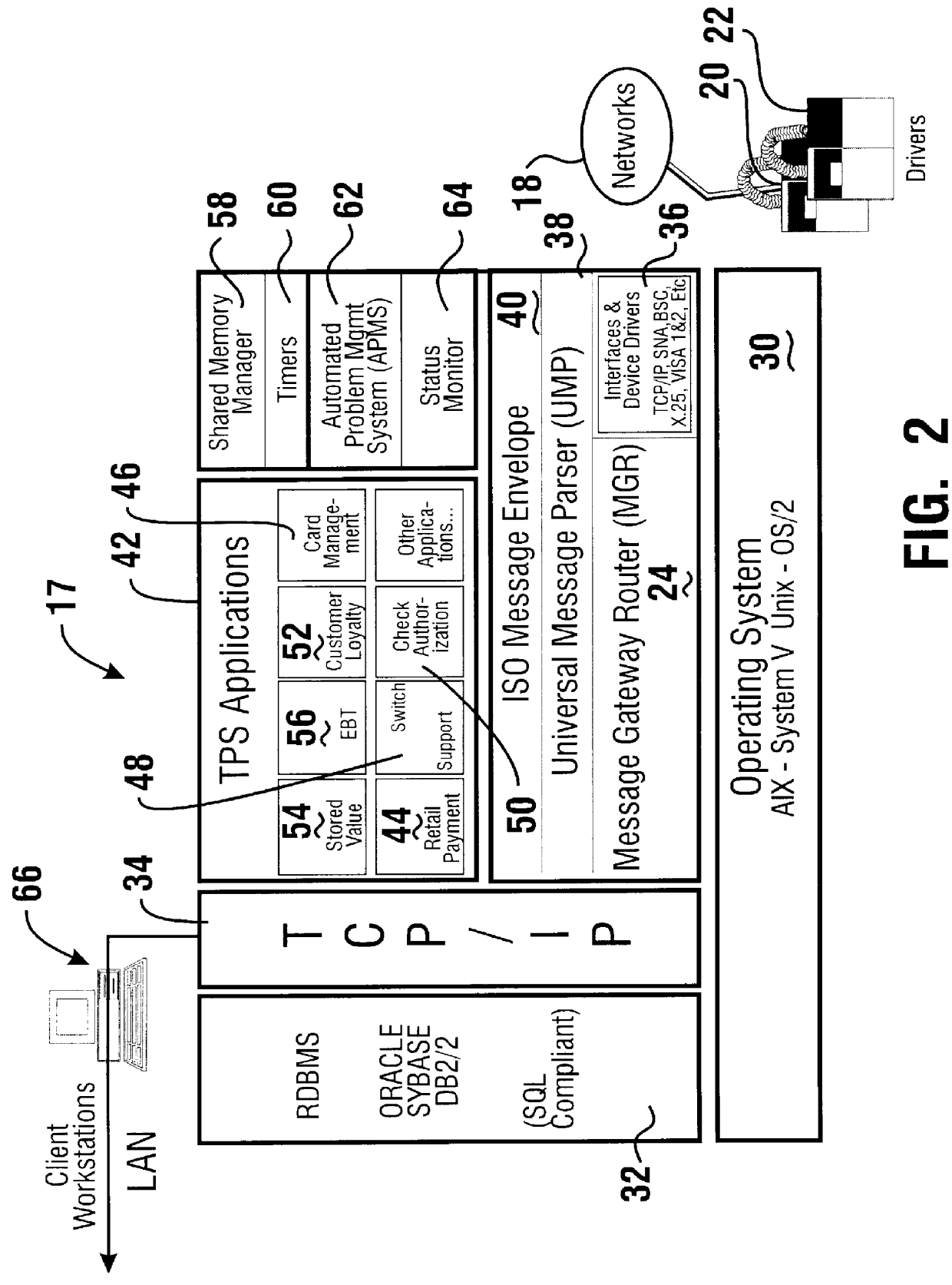

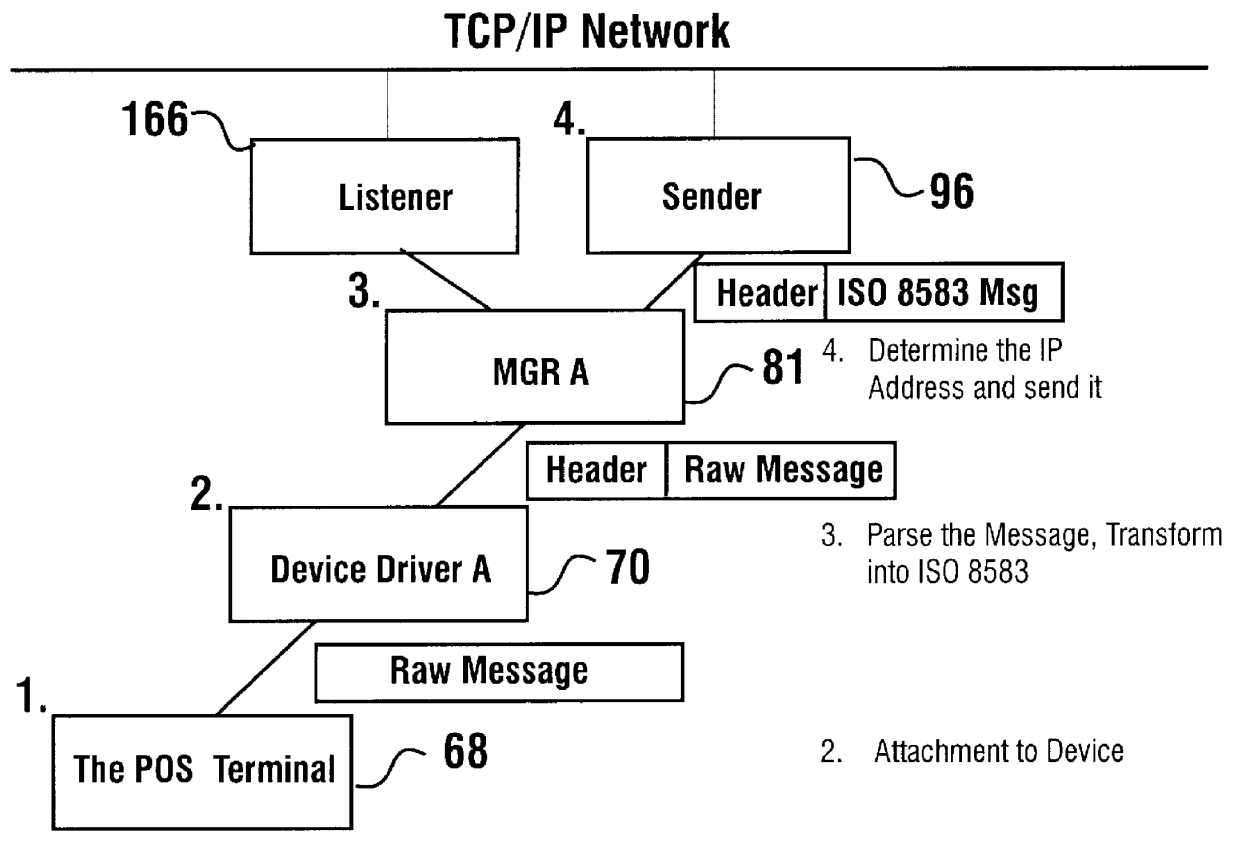

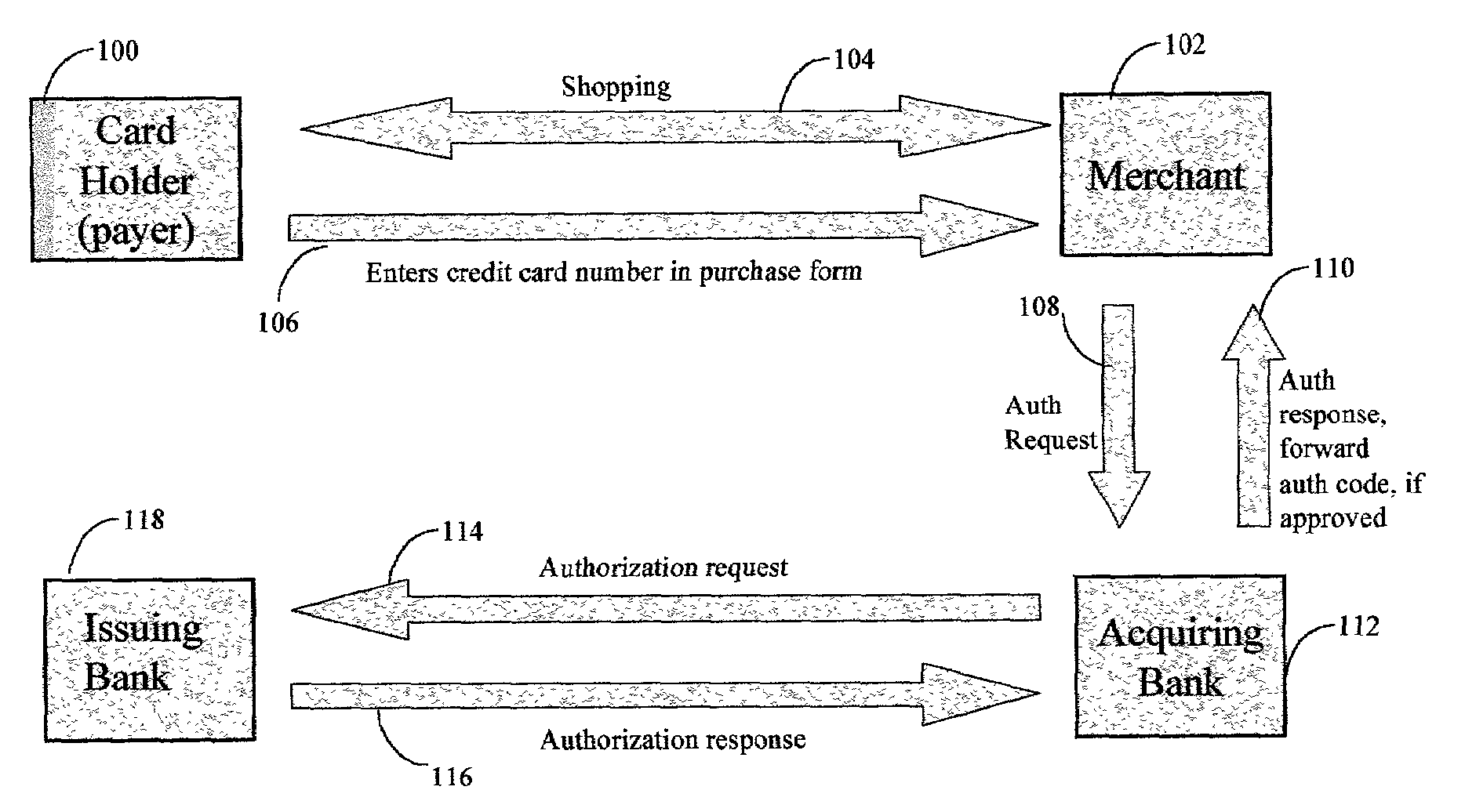

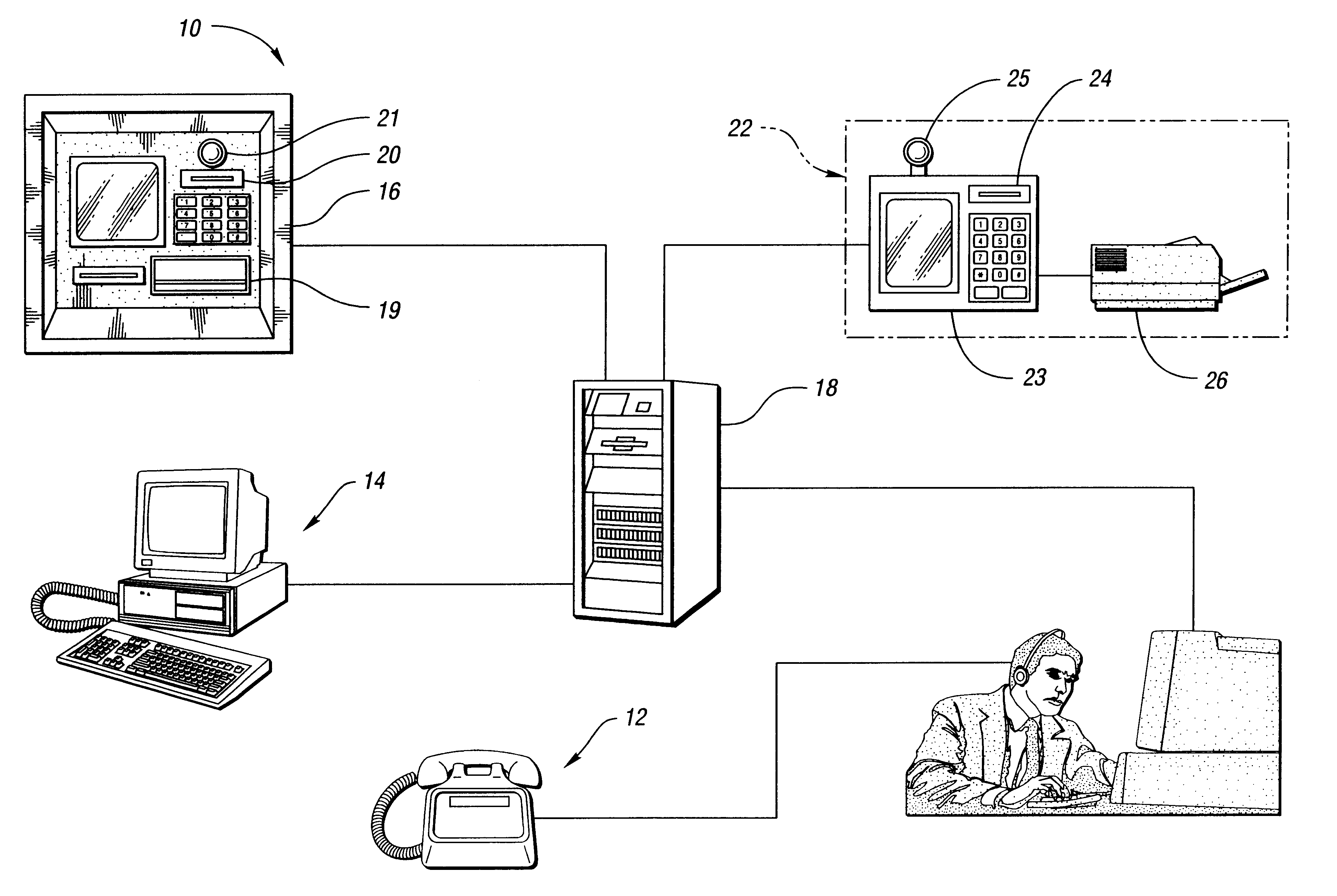

Financial transaction processing system and method

InactiveUS6039245AEasy to develop and modifyEasy to changeComplete banking machinesHand manipulated computer devicesRelational databaseTerminal equipment

A financial transaction processing system (10) enables processing transactions from various types of card activated terminal devices (12) which communicate using a variety of electronic message formats. The transaction processing system may operate to authorize transactions internally using information stored in a relational database (32) or may communicate with external authorization systems (18). The transaction processing system includes among its software components message gateway routers (MGRs) (24, 164) which operate using information stored in the relational database to convert messages from a variety of external message formats used by the external devices and authorization systems, to a common internal message format used within the system. The system further uses database information to internally route messages to message processing programs (MPPs) (108, 138) which process messages and generate messages to the external devices and authorization systems. The MGR also converts the outgoing messages from the internal message format to the external message formats which can be interpreted by the external devices and systems to which the messages are directed.

Owner:DIEBOLD NIXDORF

Persistent dynamic payment service

The invention comprises online methods, systems, and software for improving the processing of payments from financial accounts, particularly credit and debit card payments made from consumers to merchants in online transactions. The preferred embodiment of the invention involves inserting a trusted third party online service into the payment authorization process. The trusted third party authenticates the consumer and authorizes the proposed payment in a single integrated process conducted without the involvement of the merchant. The authentication of the consumer is accomplished over a persistent communication channel established with the consumer before a purchase is made. The authentication is done by verifying that the persistent channel is open when authorization is requested. Use of the third party services allows the consumer to avoid revealing his identity and credit card number to the merchant over a public network such as the Internet, while maintaining control of the transaction during the authorization process.

Owner:FISHER DOUGLAS C

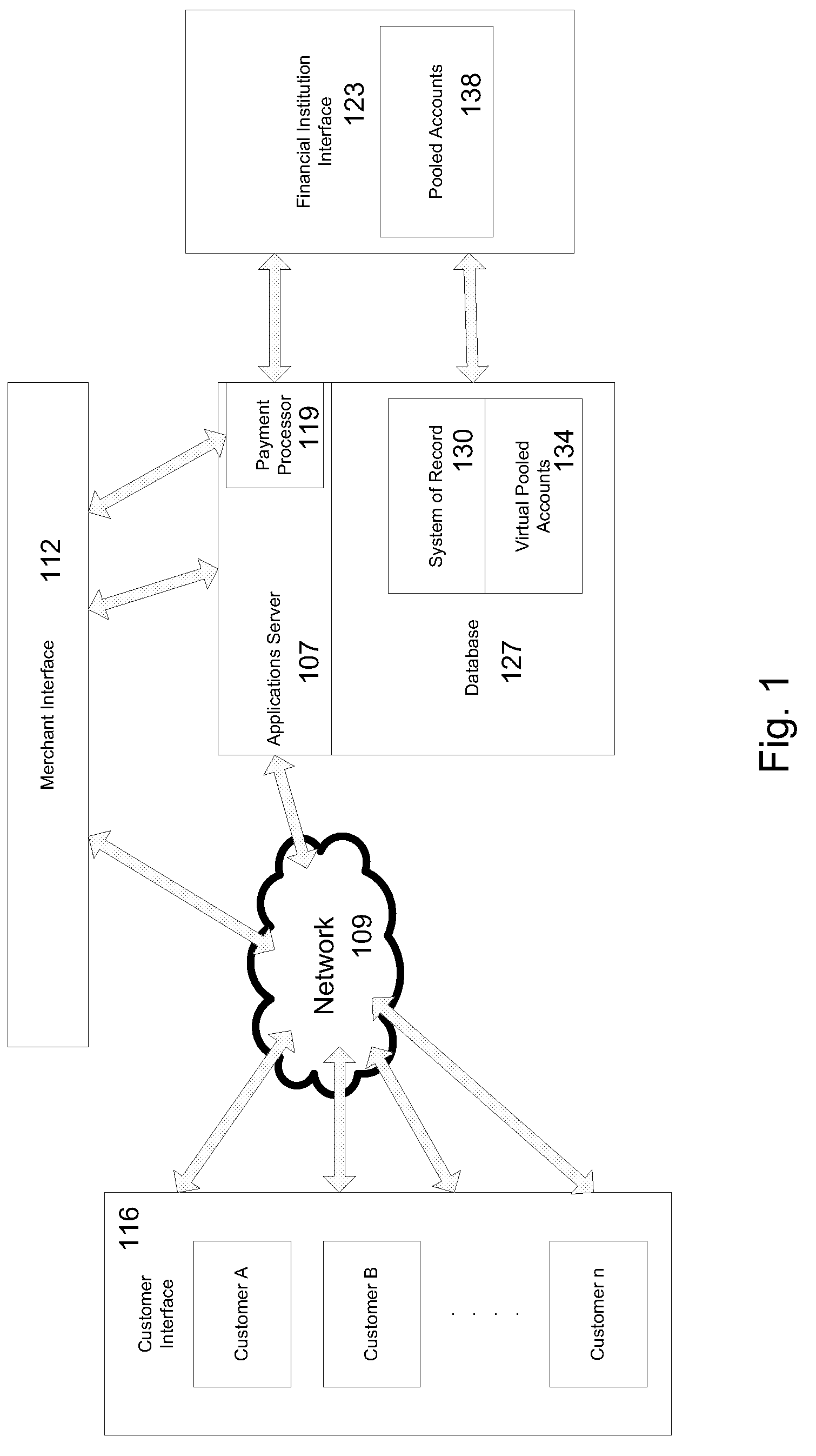

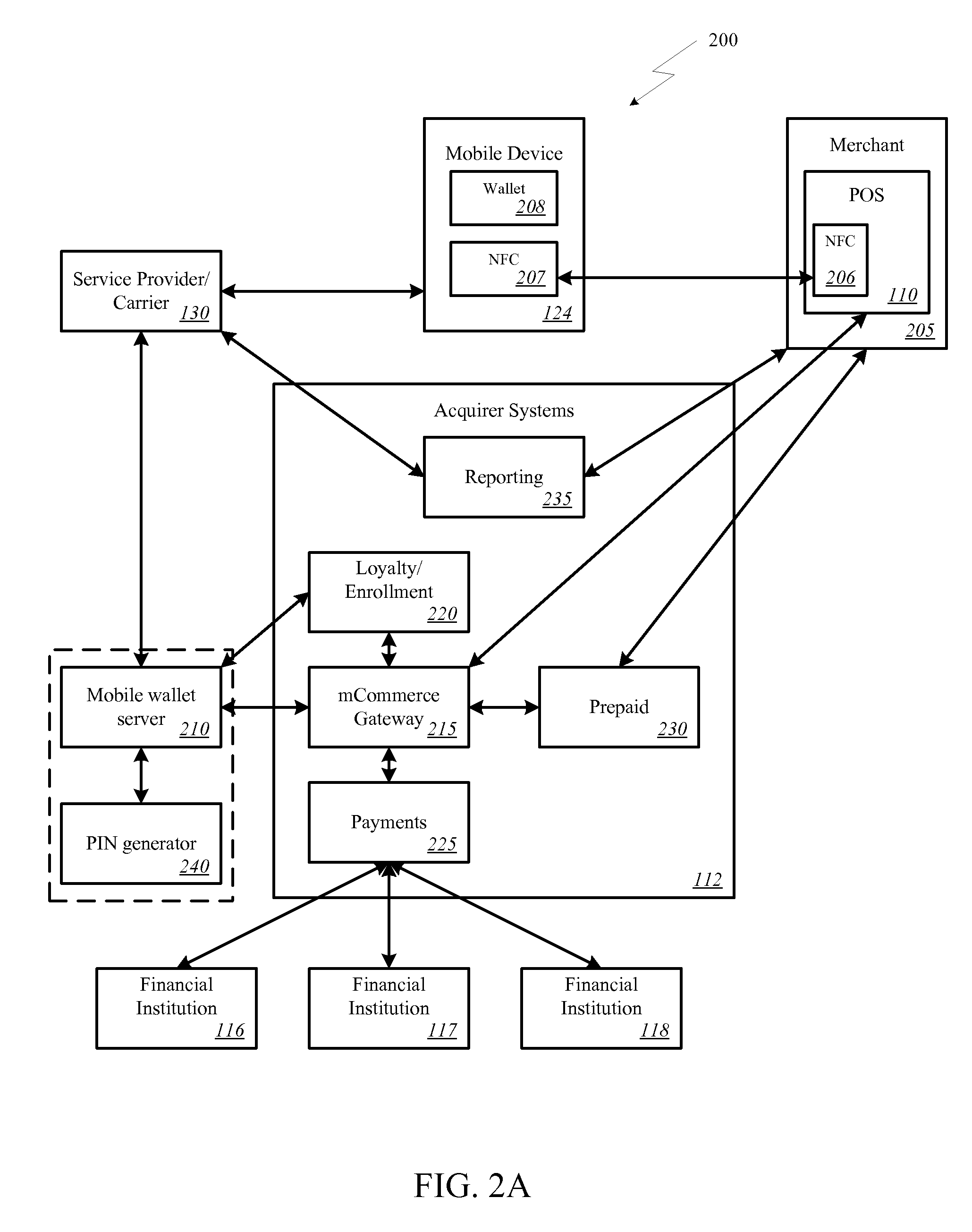

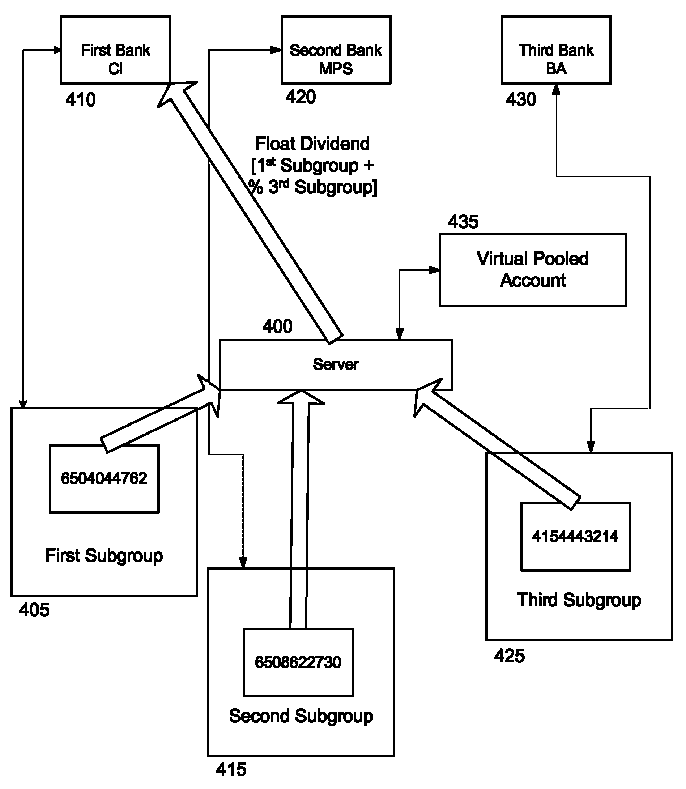

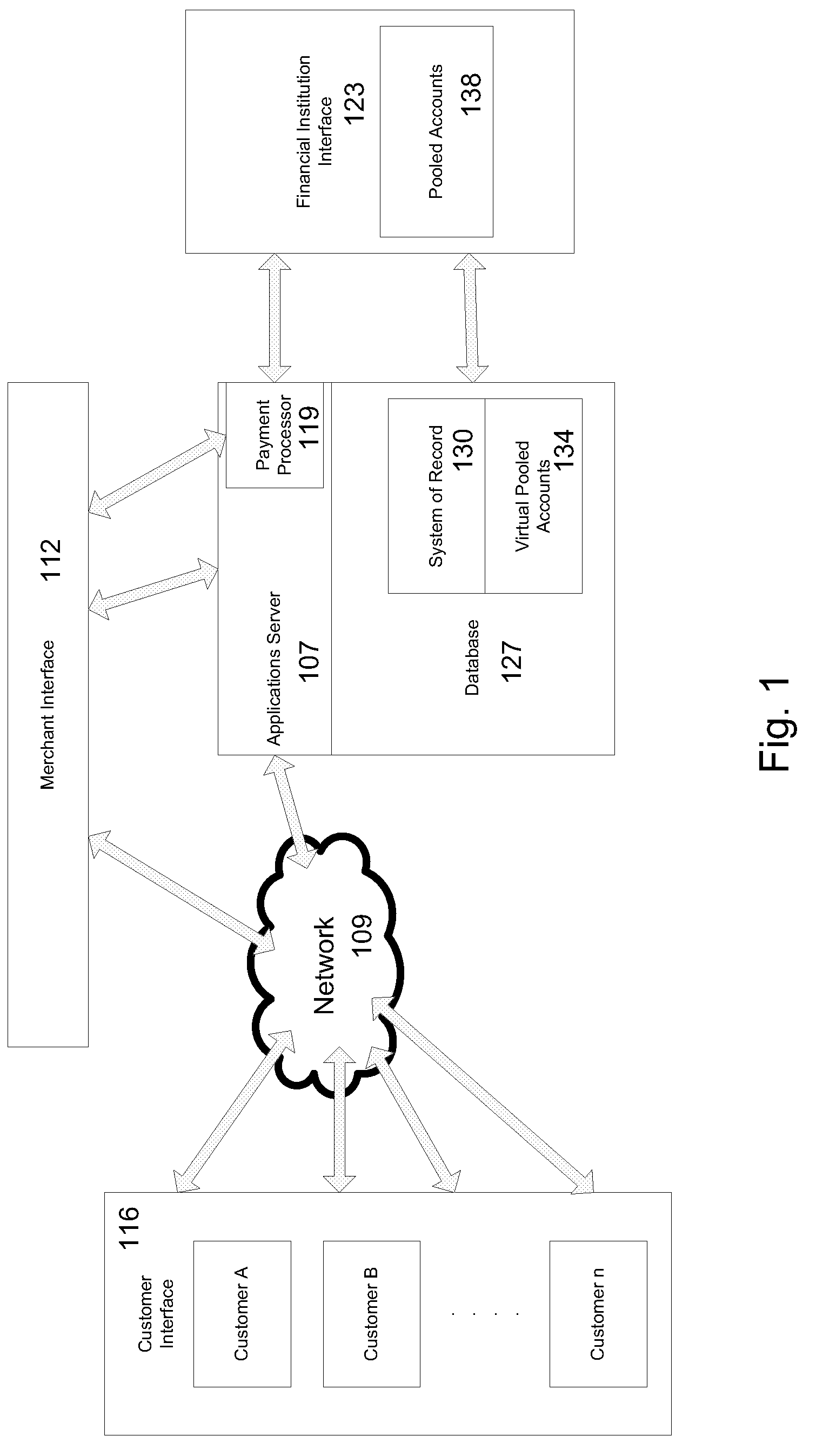

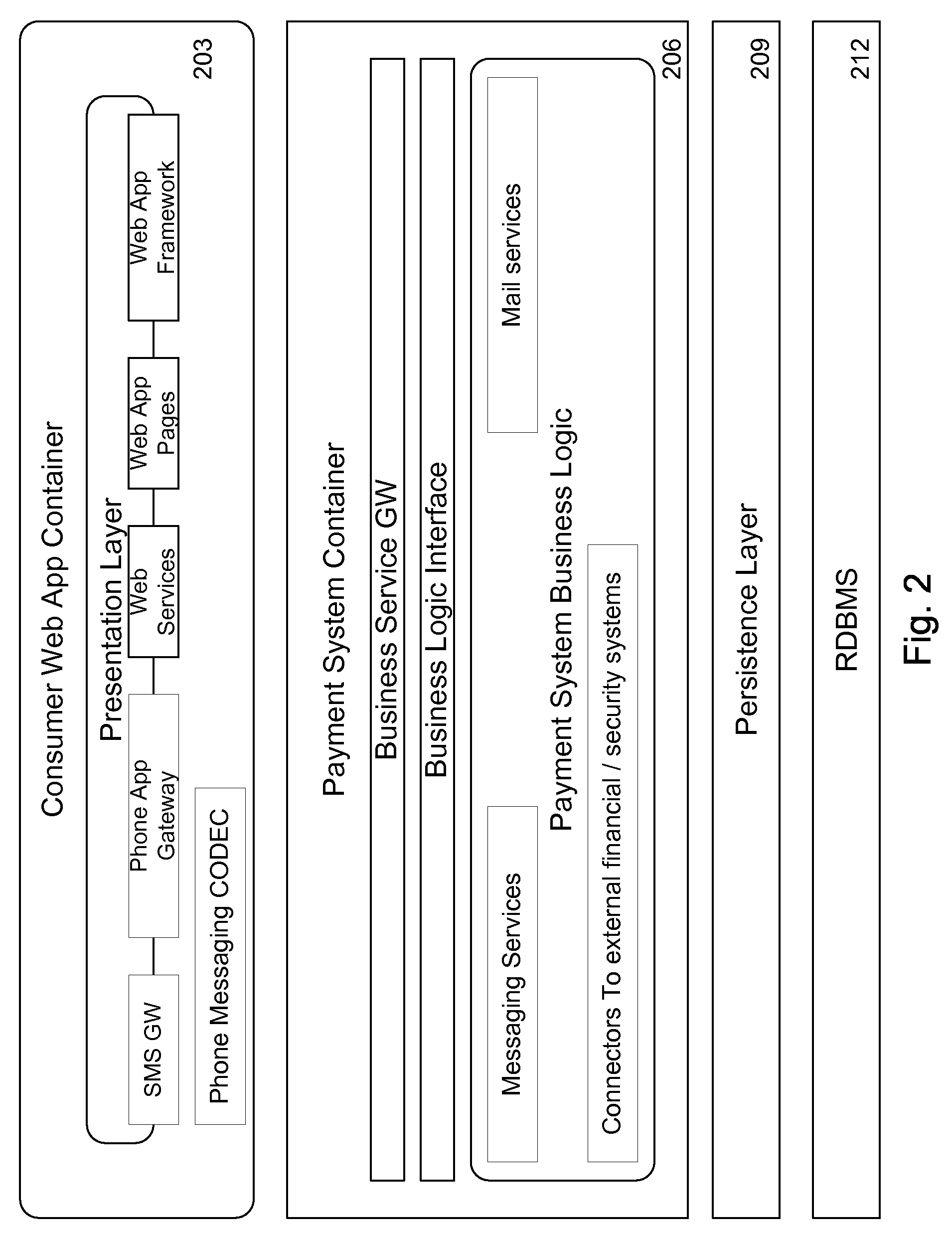

Virtual pooled account for mobile banking

ActiveUS7873573B2Reduce settlement and operational cost of systemThe process is simple and fastComplete banking machinesFinanceOperational costsSimulation

A virtual pooled account is used in operating a system having multiple financial partners. In a specific implementation, the system is a mobile banking system. Instead of maintaining separate general ledgers for each financial institution, the system will keep one general virtual pooled account. This will reduce the settlement and operational costs of the system. The owner of the virtual pooled account will receive the float on the virtual pooled account, and this float will be distributed to the multiple financial partners according to a formula.

Owner:OBOPAY MOBILE TECH INDIA PTE LTD

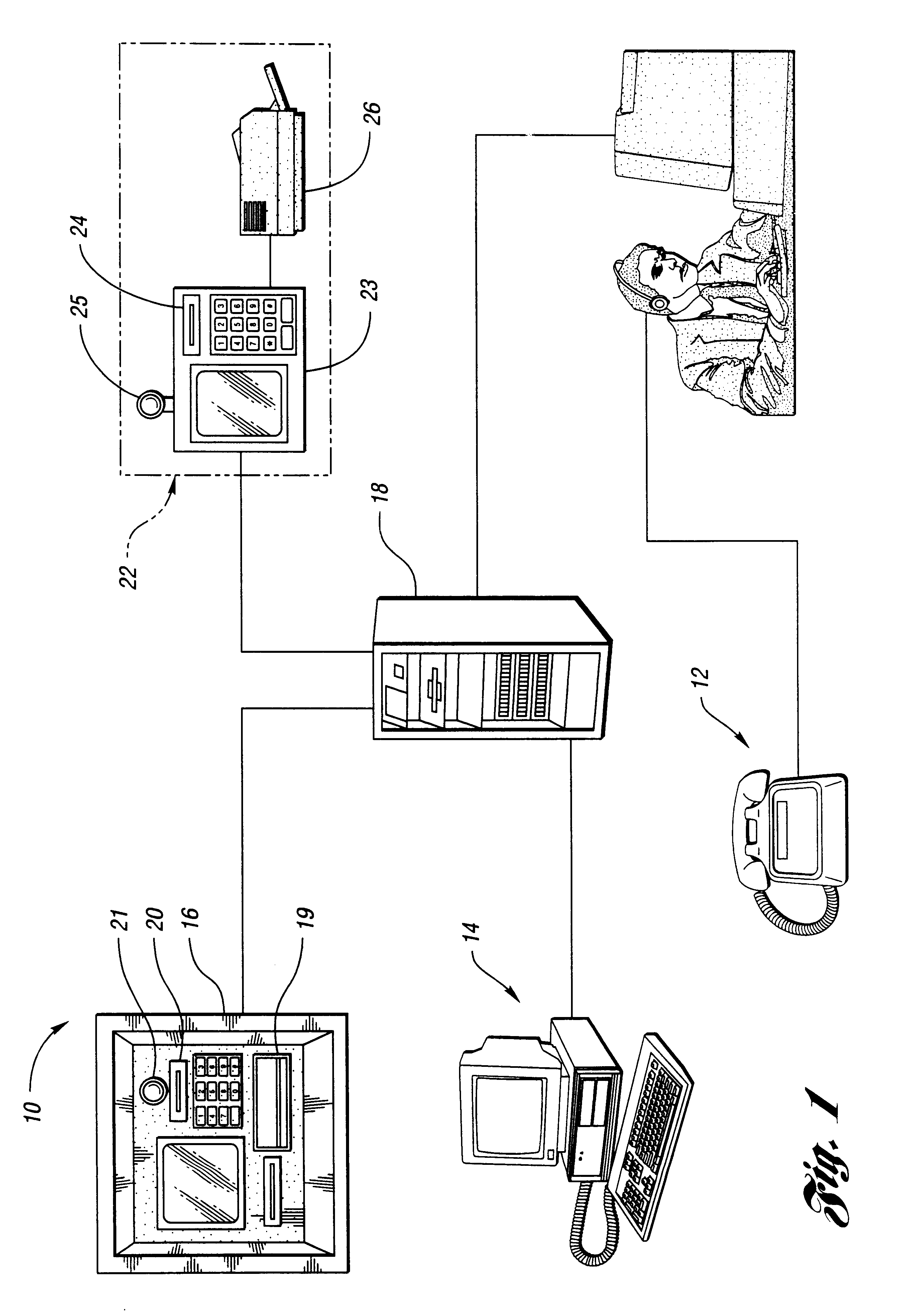

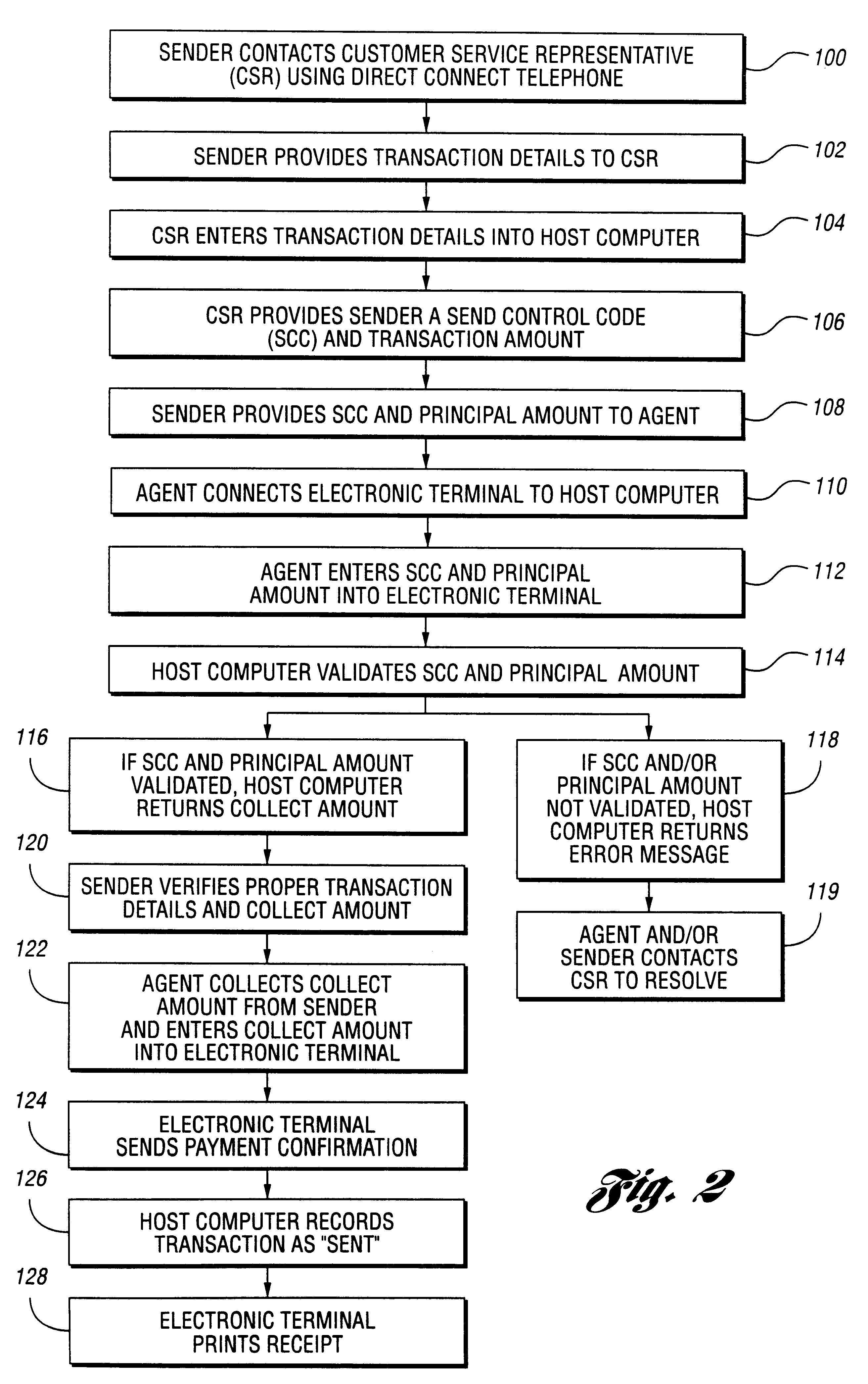

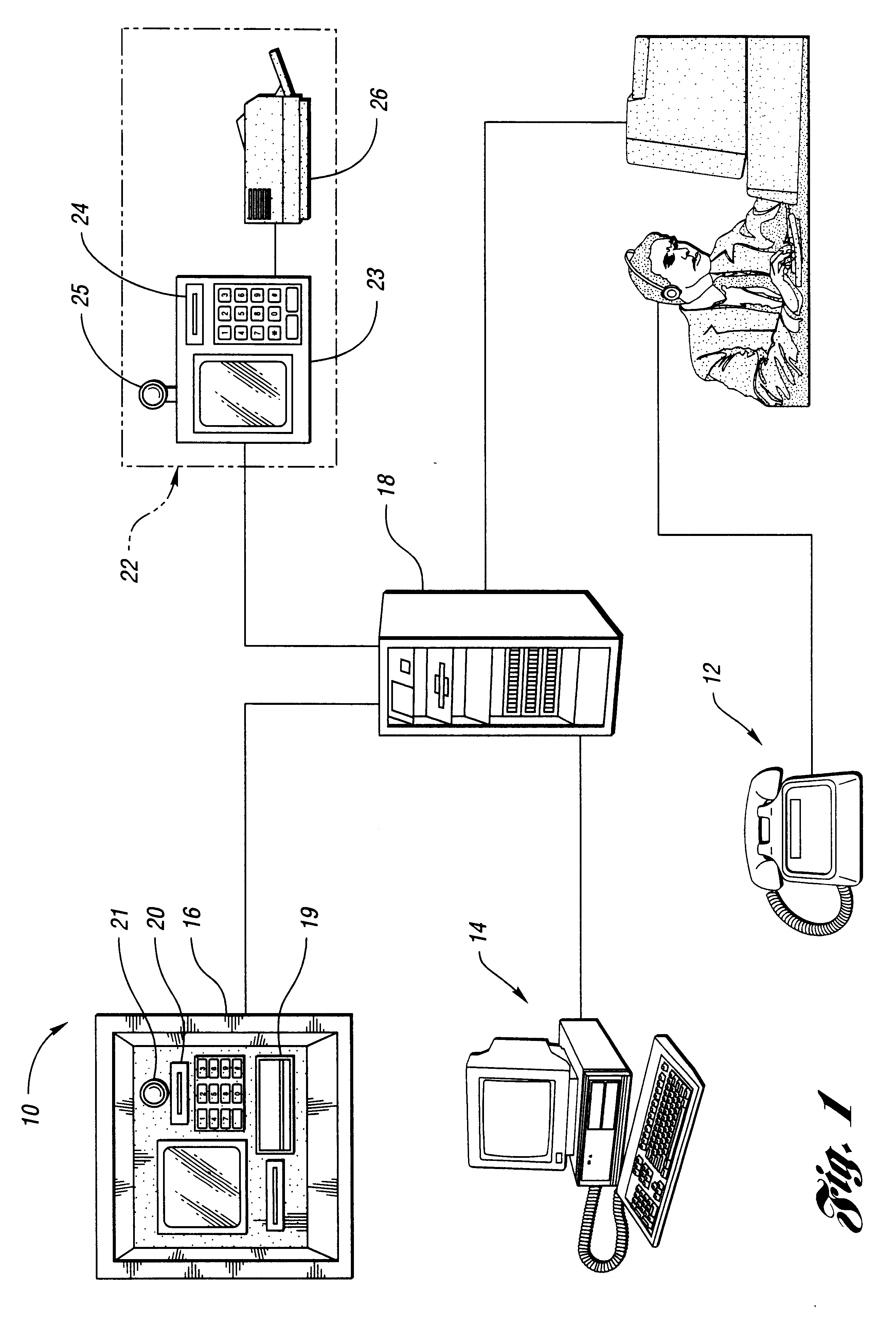

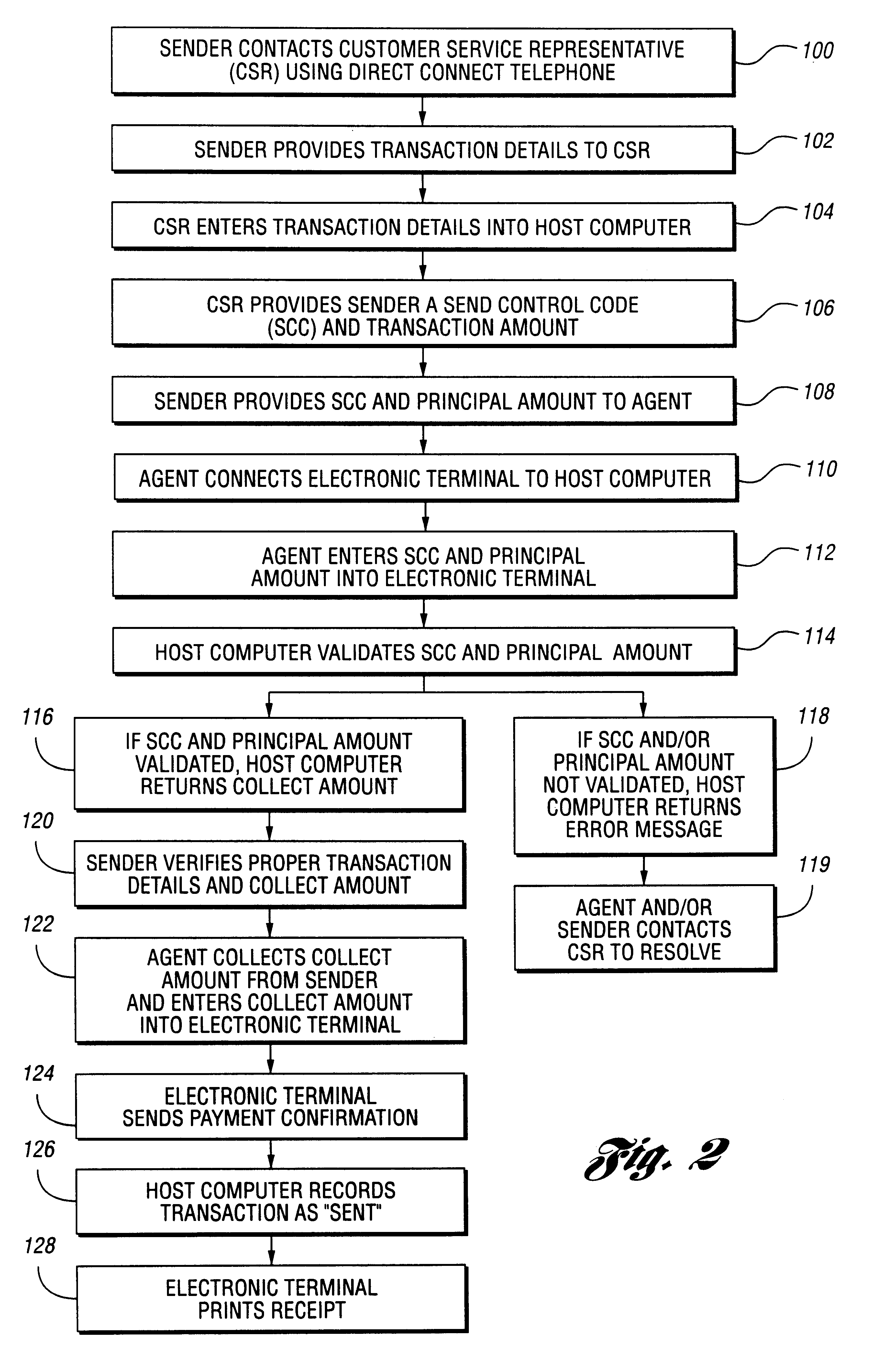

Method and system for performing money transfer transactions

InactiveUS6488203B1Shorten transaction timeImprove accuracyComplete banking machinesFinanceComputer scienceDatabase

A method of performing a send money transfer transaction through a financial services institution includes storing transaction details on a data base, wherein the transaction details include a desired amount of money to be sent; establishing a code that corresponds to the transaction details stored on the data base; entering the code into an electronic transaction fulfillment device in communication with the data base to retrieve the transaction details from the data base; and determining a collect amount based on the transaction details. A system for performing a send money transfer transaction is also disclosed.

Owner:THE WESTERN UNION CO

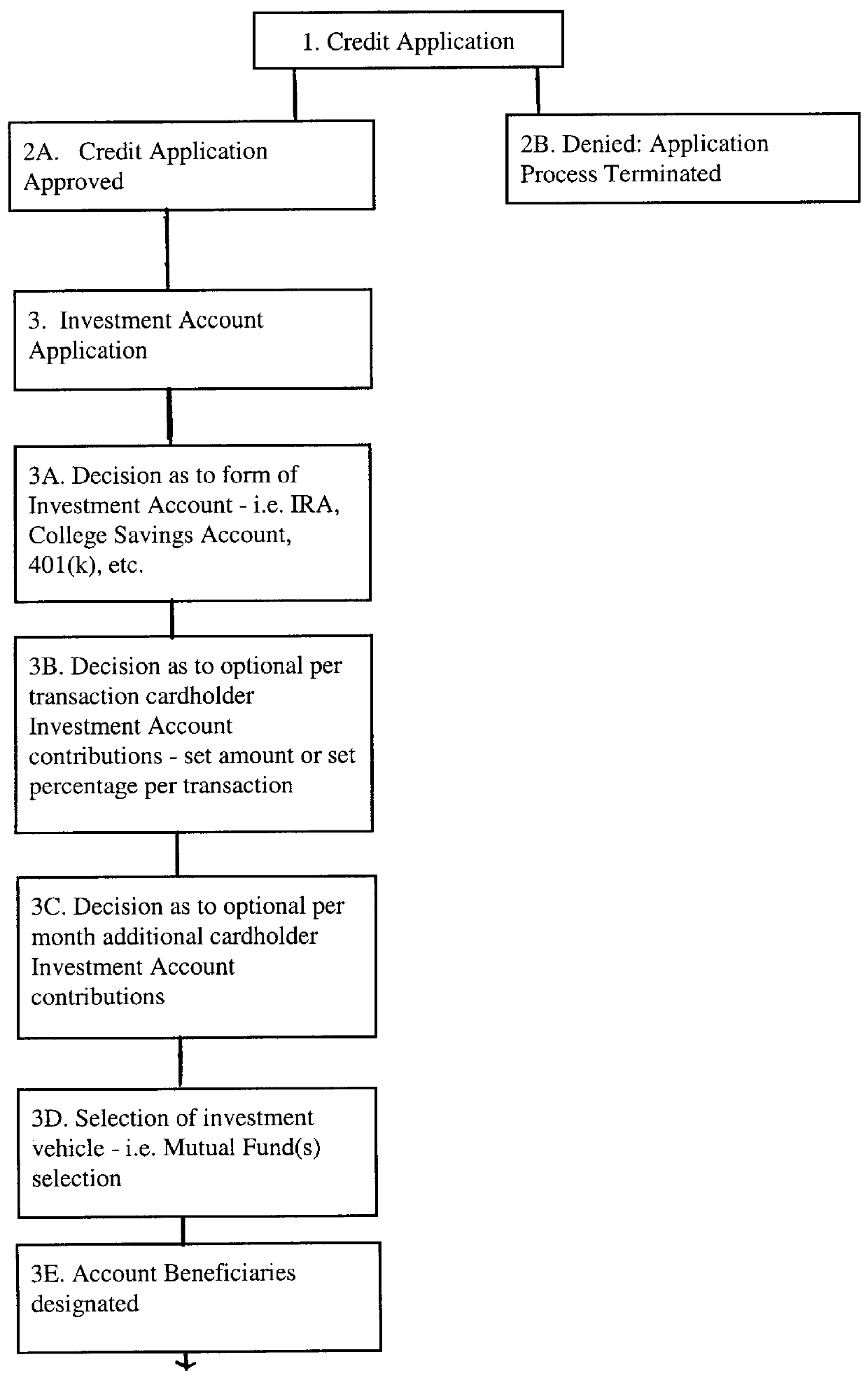

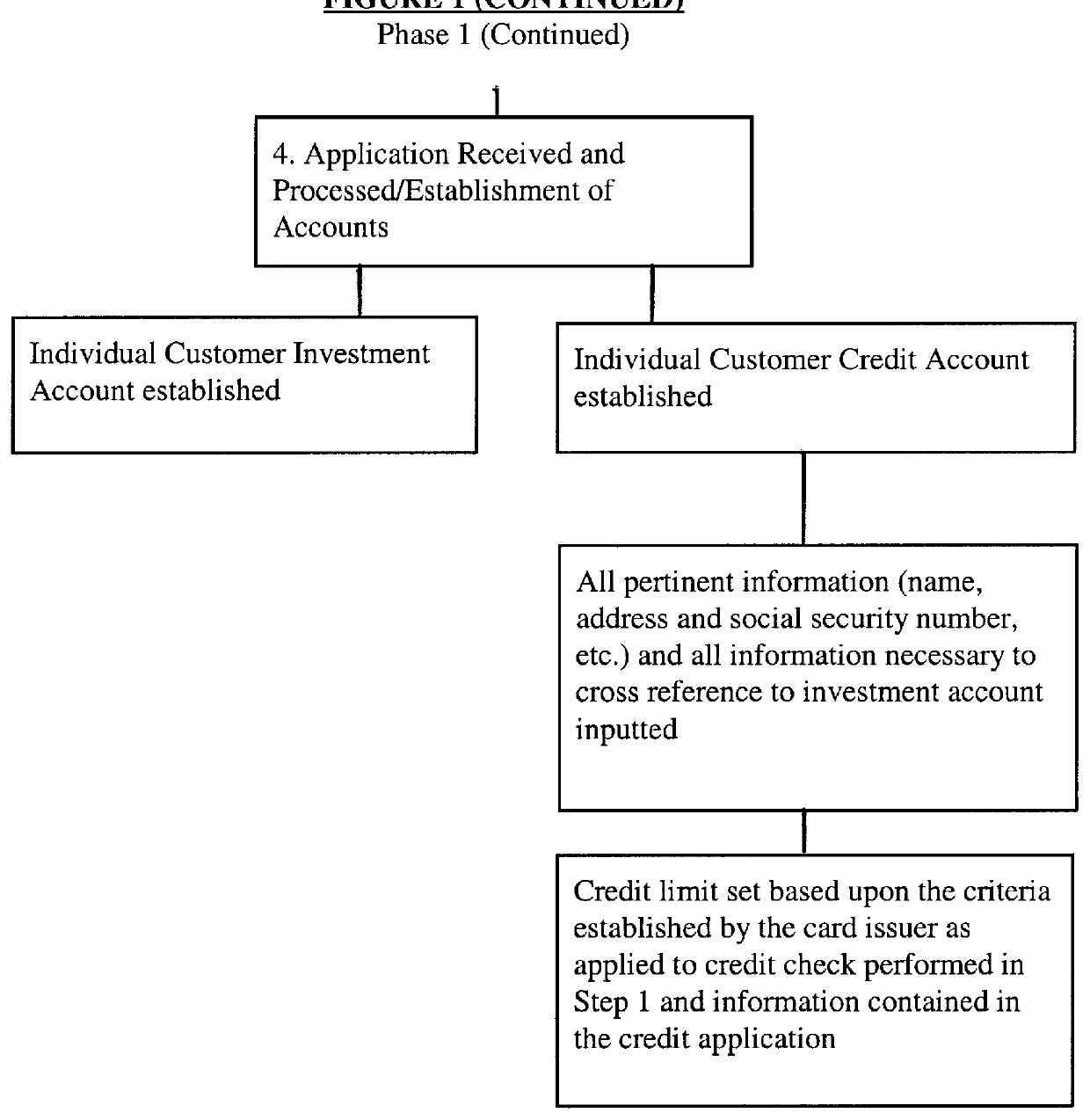

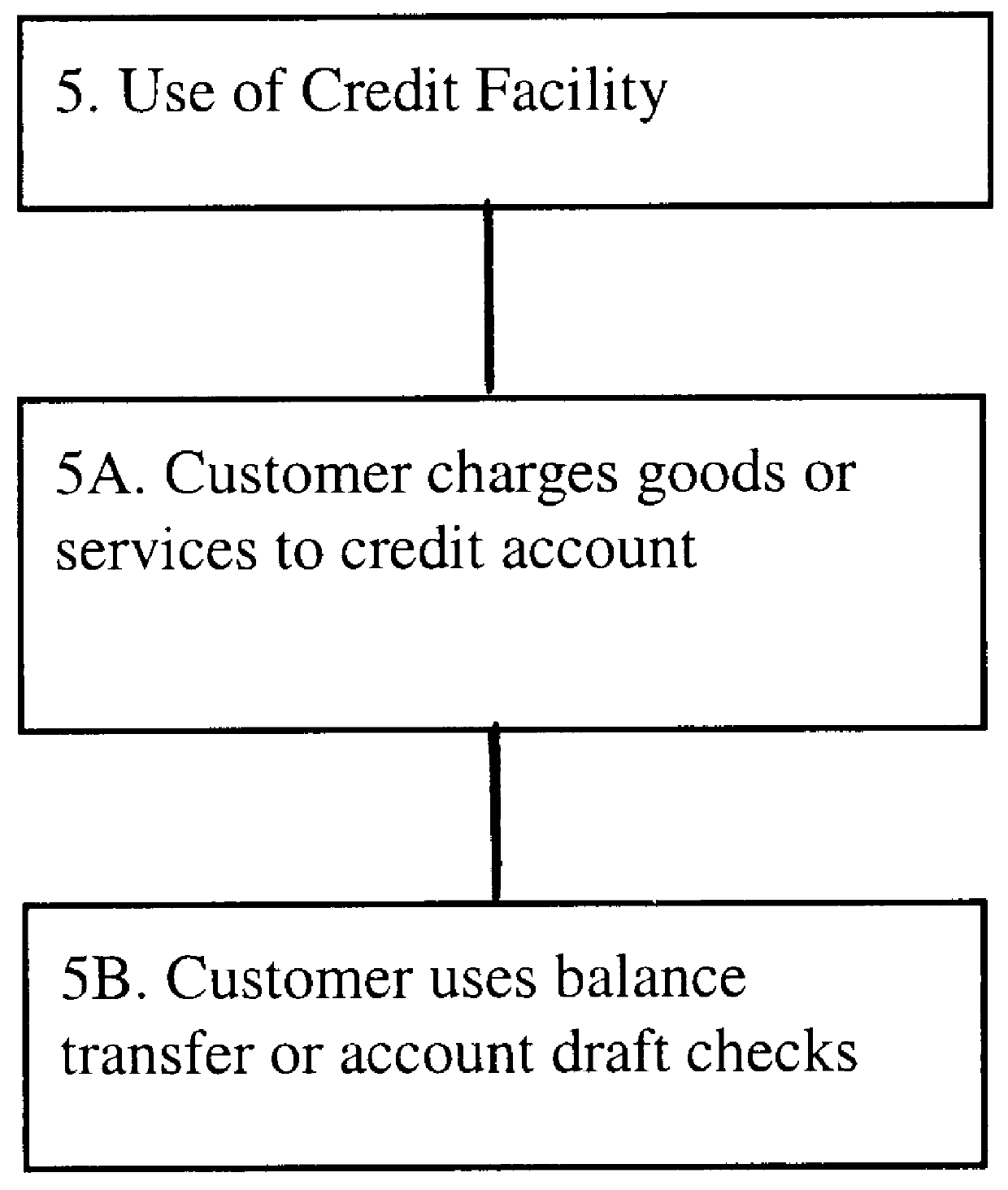

System and method for automatically investing a portion of a credit card interest charged amount in an investment account

InactiveUS6070153ASolve low usageLow savingComplete banking machinesFinanceCredit card interestCollege education

A system and methods for automatically investing, a portion of interest charged amount paid by the card issuer or the cardholder, on a credit card account, to an individual retirement account, taxpayer relief act of 1997 IRA, "Roth Act" or "Super IRA", college education IRA or spousal IRA (herein, collectively, "IRA"), college savings account, 401(K) plan (with or without linkage to a company expense account credit card), dividend reinvestment program (in stock of the card issuing company or otherwise) or other investment feature.

Owner:SIMPSON MARK S

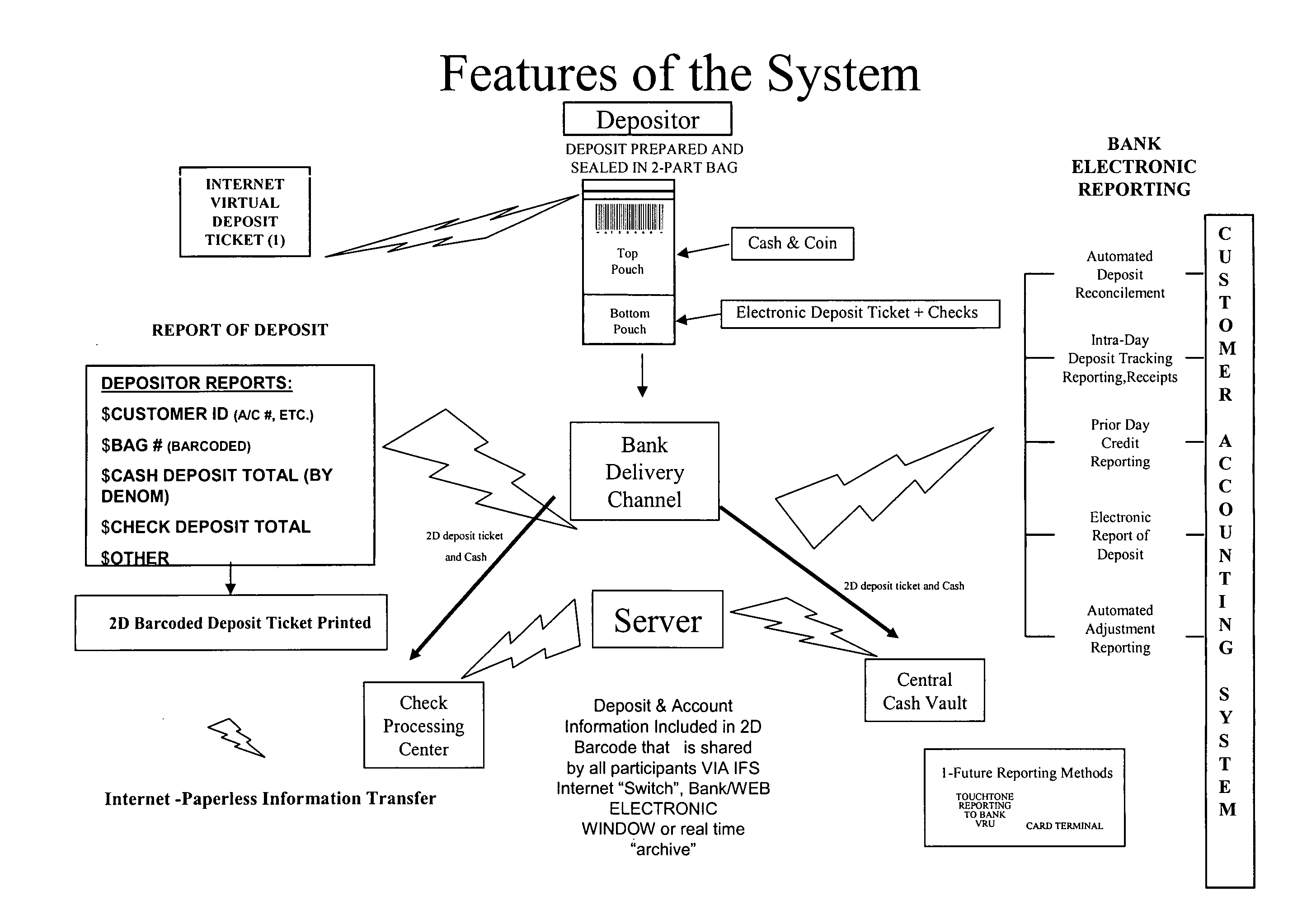

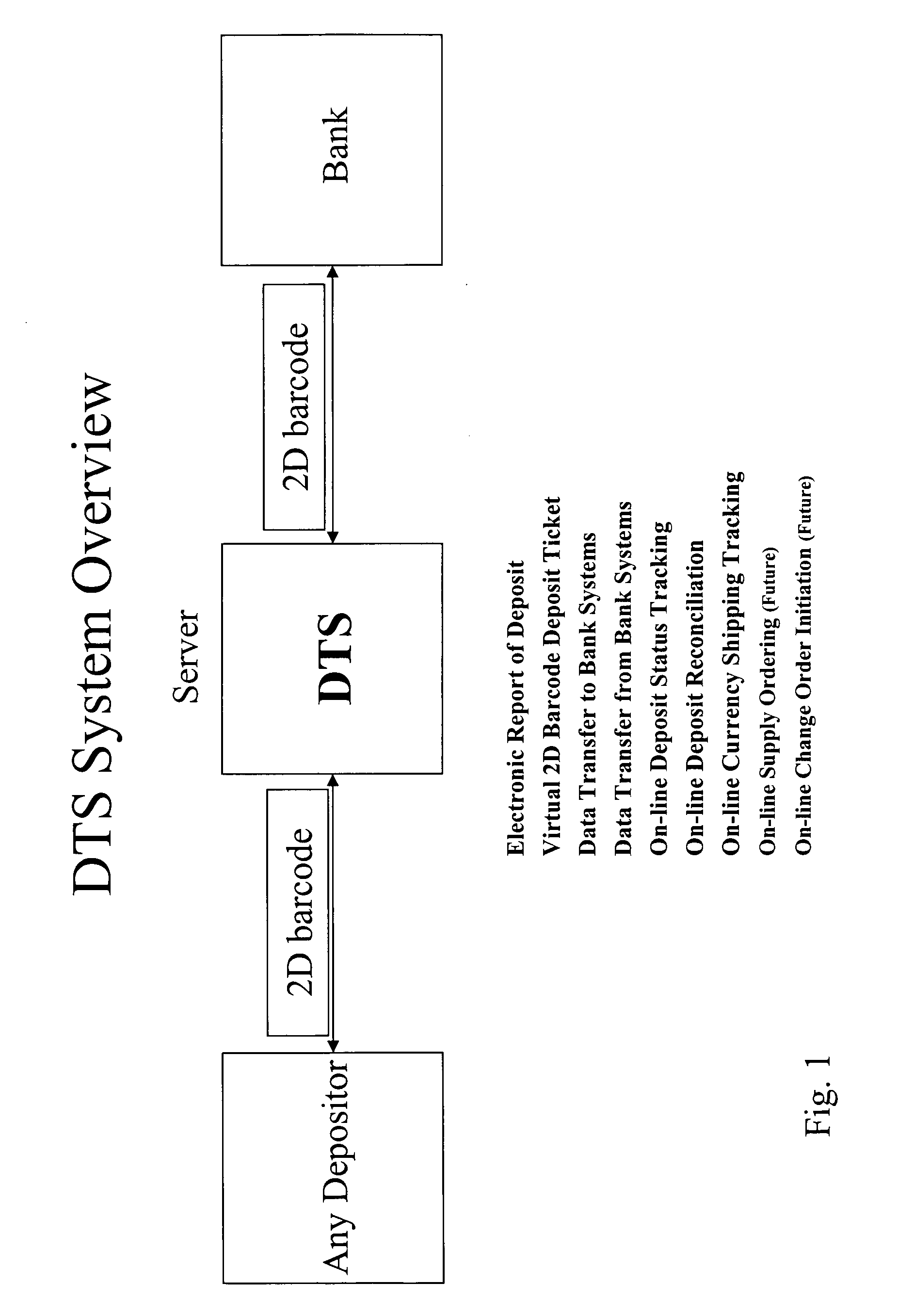

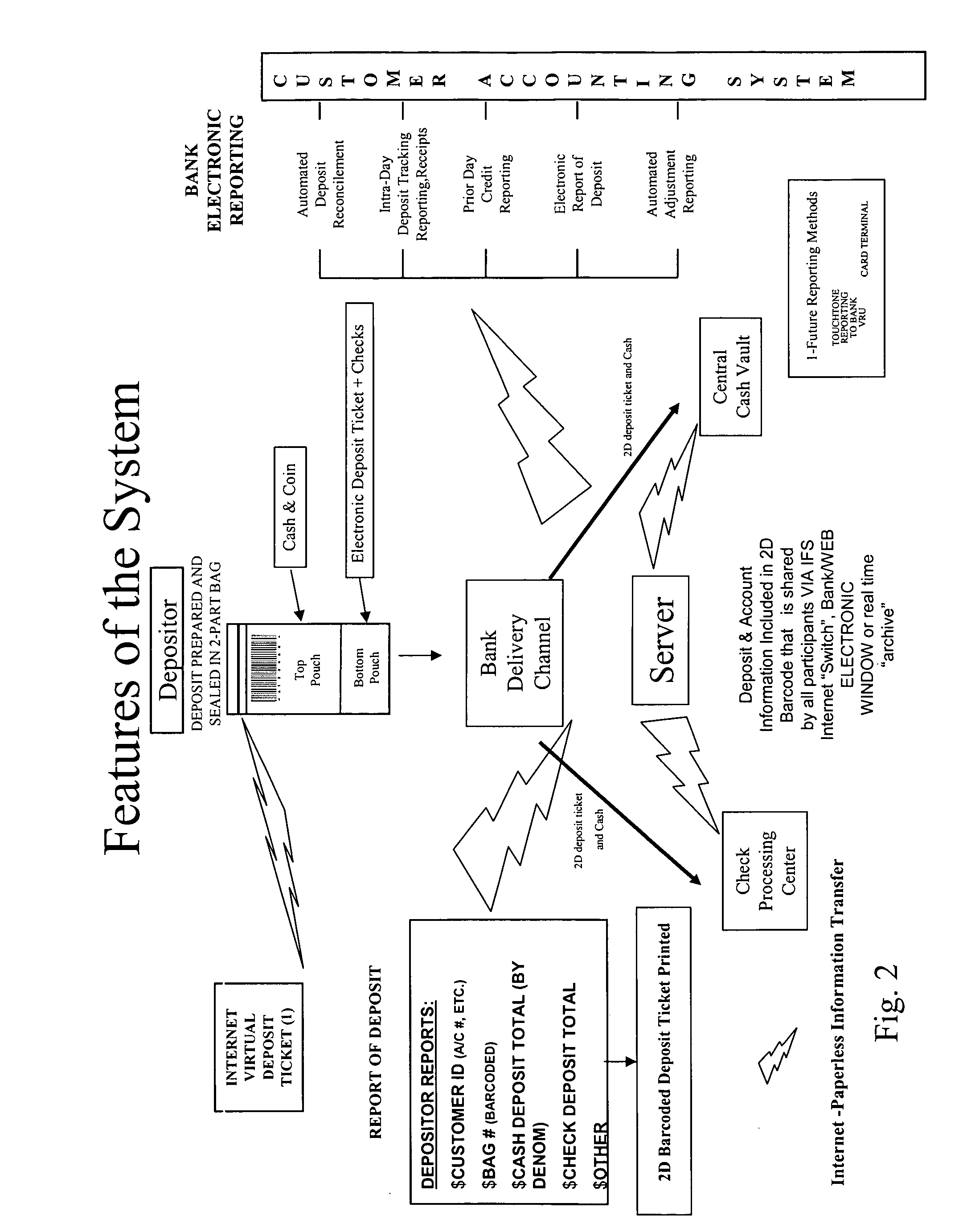

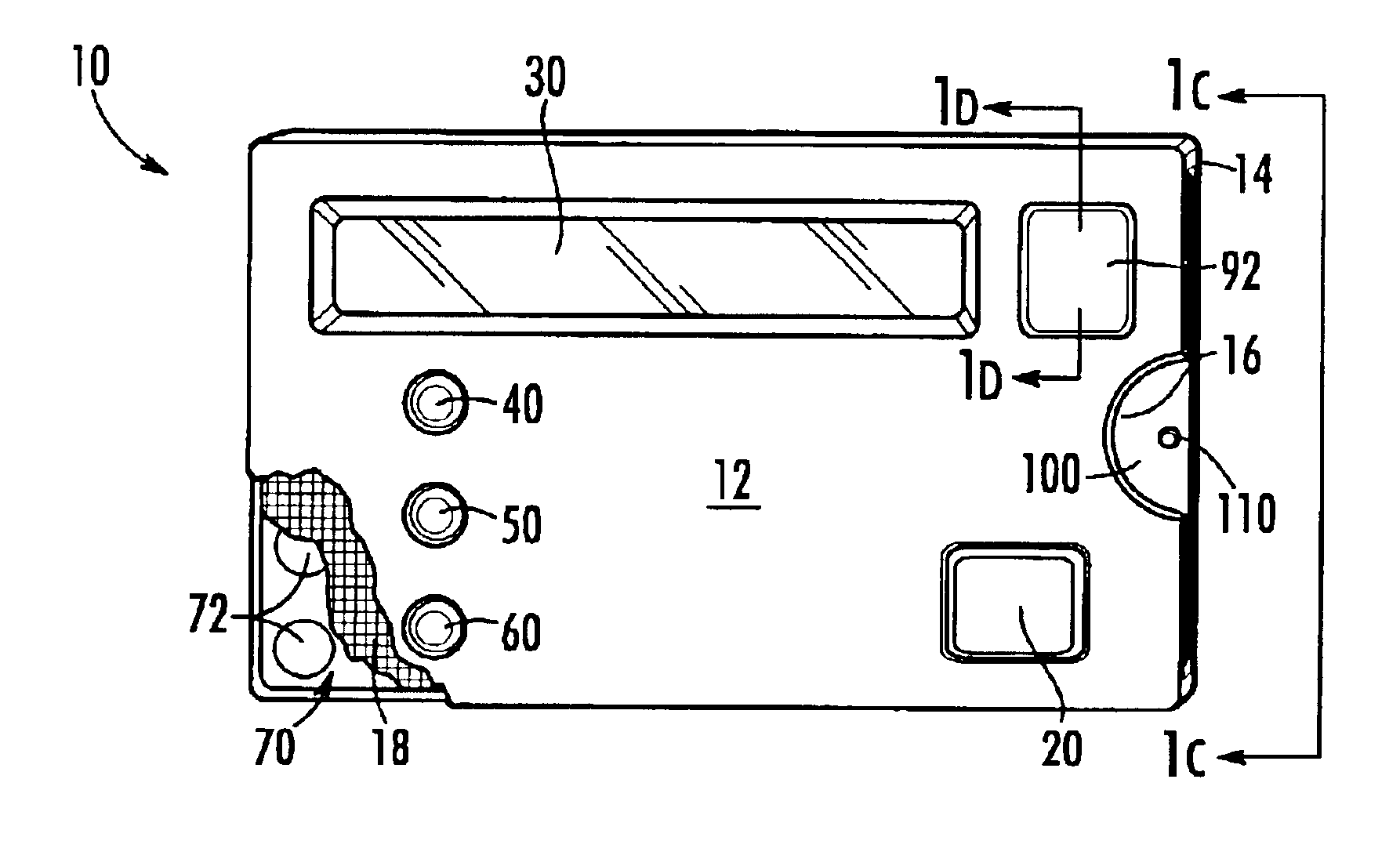

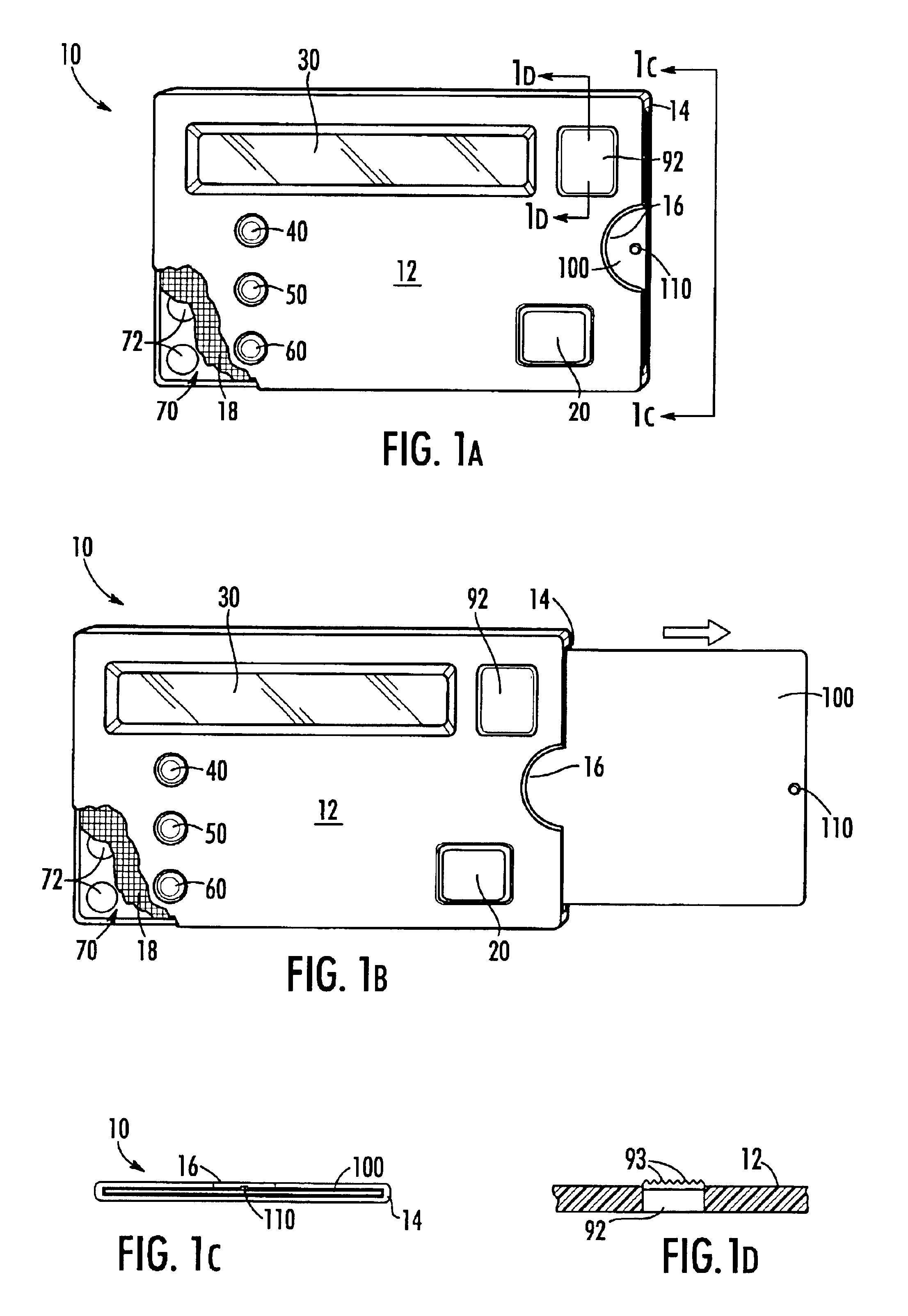

System and method to create electronic deposit records and to track the status of a deposit

A method of making, tracking and confirming the receipt of bank deposits by a user to a financial institution is disclosed. The method includes first accessing a user account on a database, entering deposit information including the account number and amount of the intended deposit on the database to create an electronic deposit record, and then encoding the deposit information in a machine readable format. The information is then associated with the encoded deposit information in close proximity with the deposit, creating a deposit package. The package is then transmitted to a financial institution or armored car carrier where the machine readable encoded deposit information is read and transmitted to a database that contains information about the account and status of the deposit.

Owner:INT FINANCIAL SERVICES

Transaction card system having security against unauthorized usage

InactiveUS6991155B2Prevent illegal useComplete banking machinesInput/output to record carriersIdentification deviceData transmission

A system having a host having information regarding at least one transaction card account. The host functions to transfer card data to a drone card carried within the host. The host includes a biometric sensor or other suitable identification means for authentication of the user prior to use of the drone card. Once the user is authenticated, the drone card provides a readable identifier that corresponds to a transaction card account selected by the user. The functions of host could alternatively be integrated into the drone card.

Owner:LASER CARD LLC

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com