Patents

Literature

151results about How to "Shorten transaction time" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

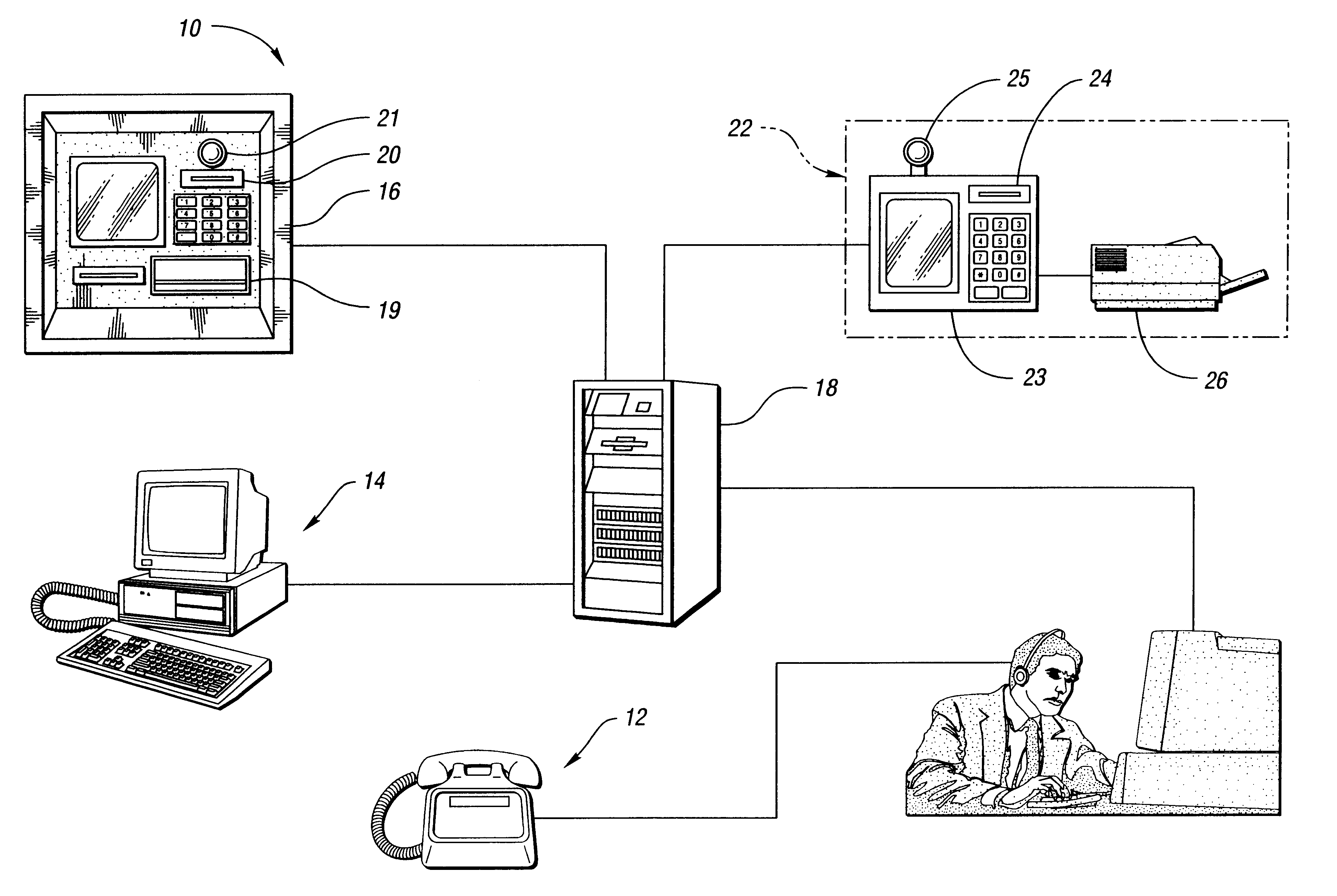

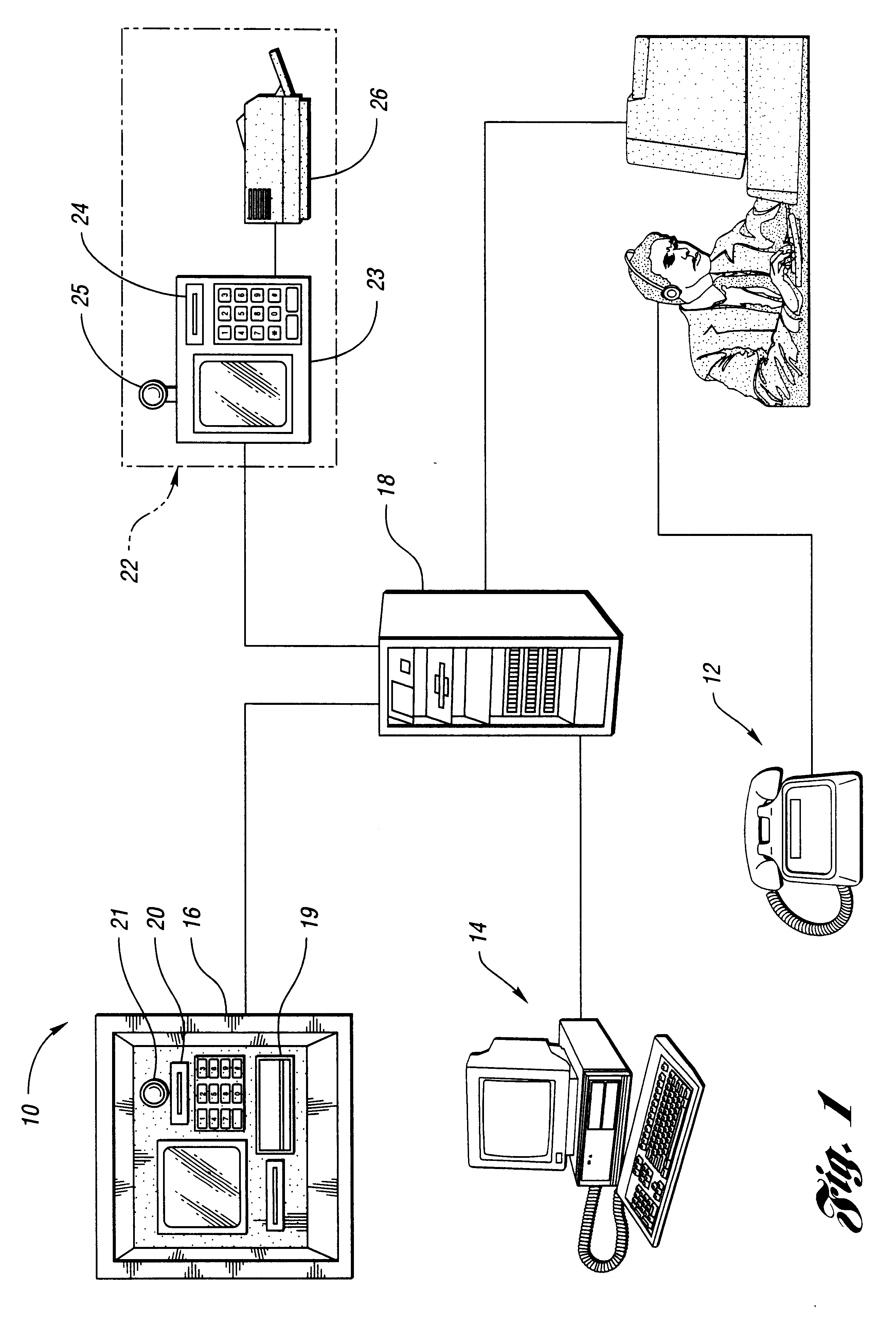

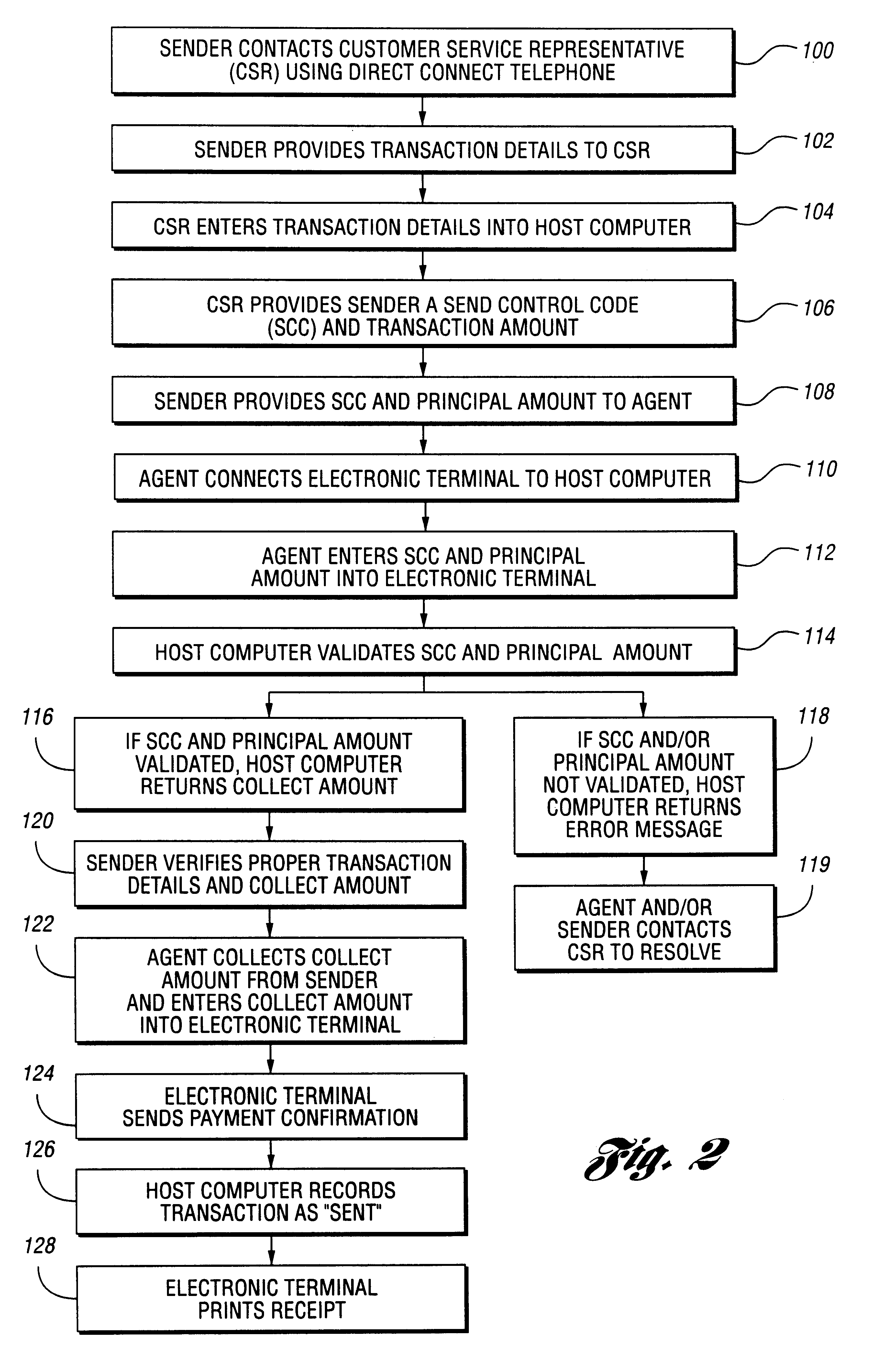

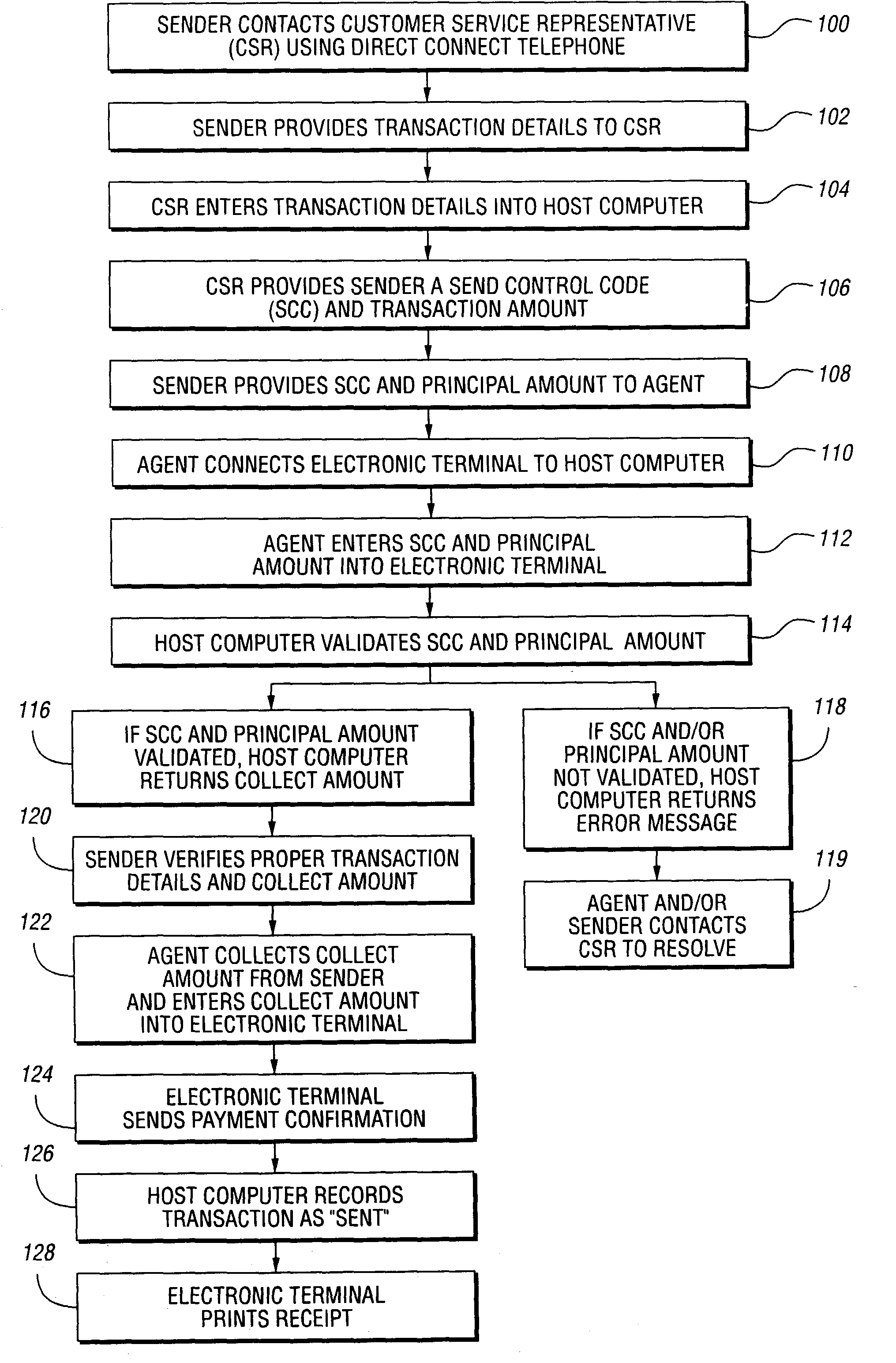

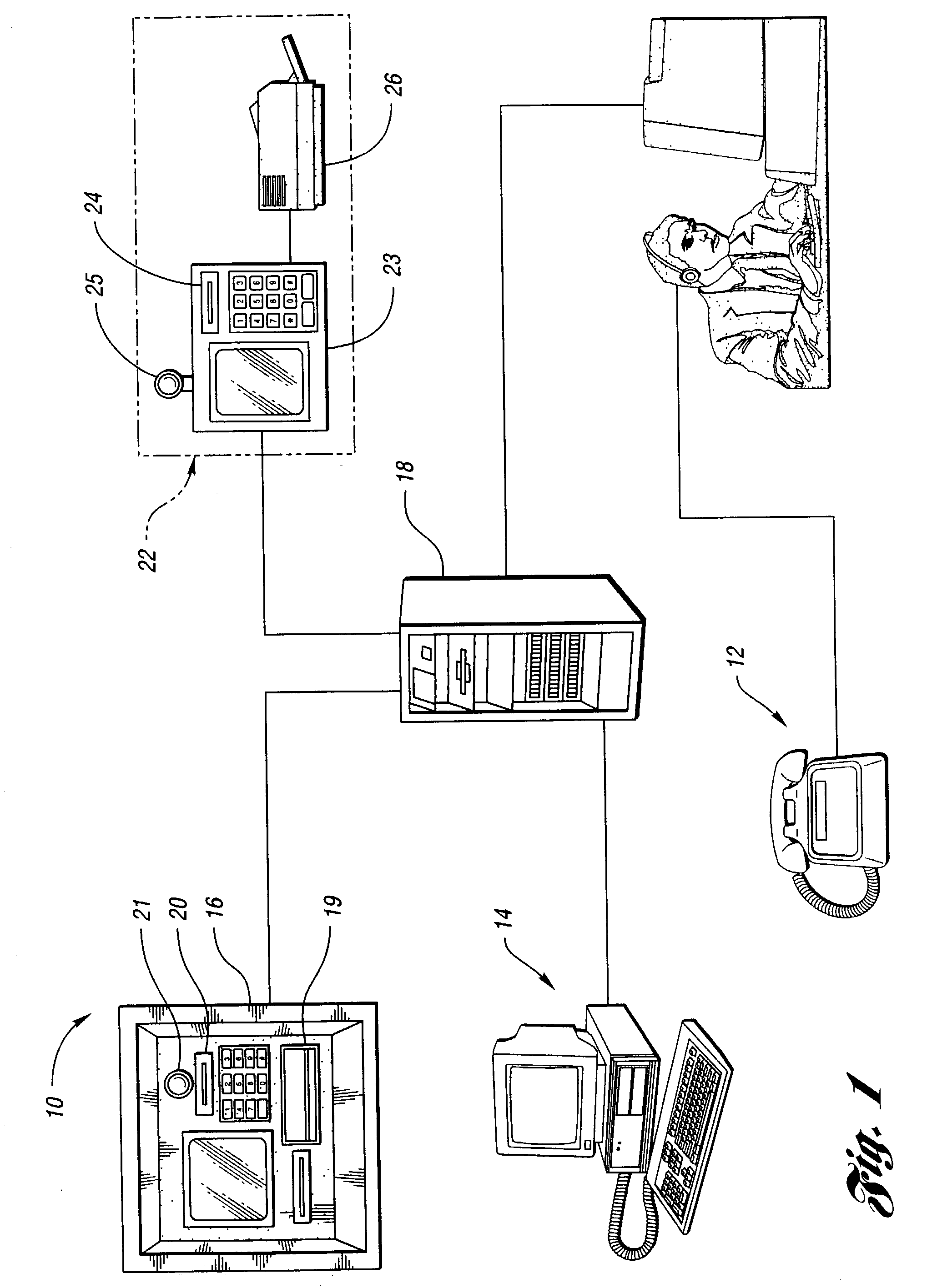

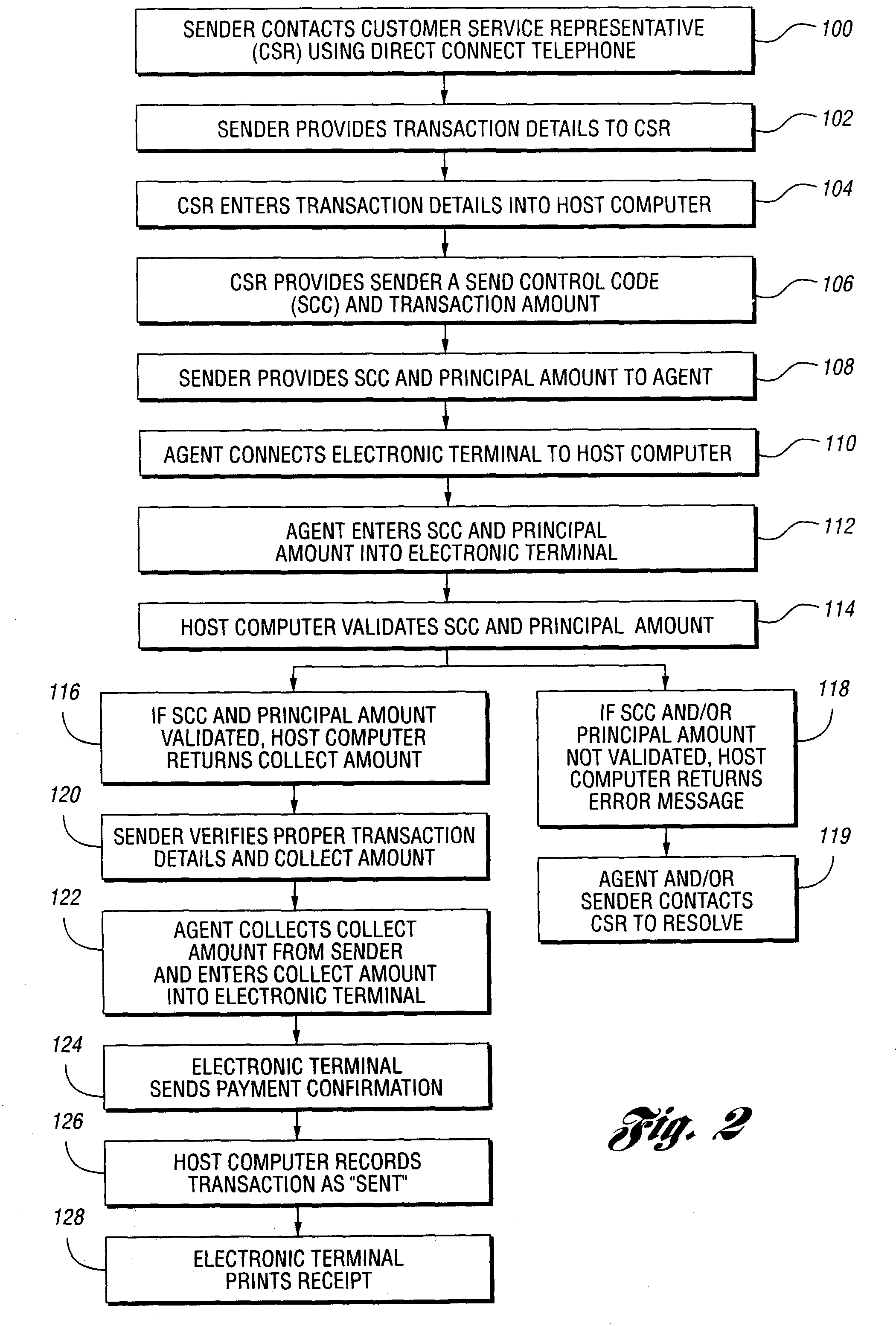

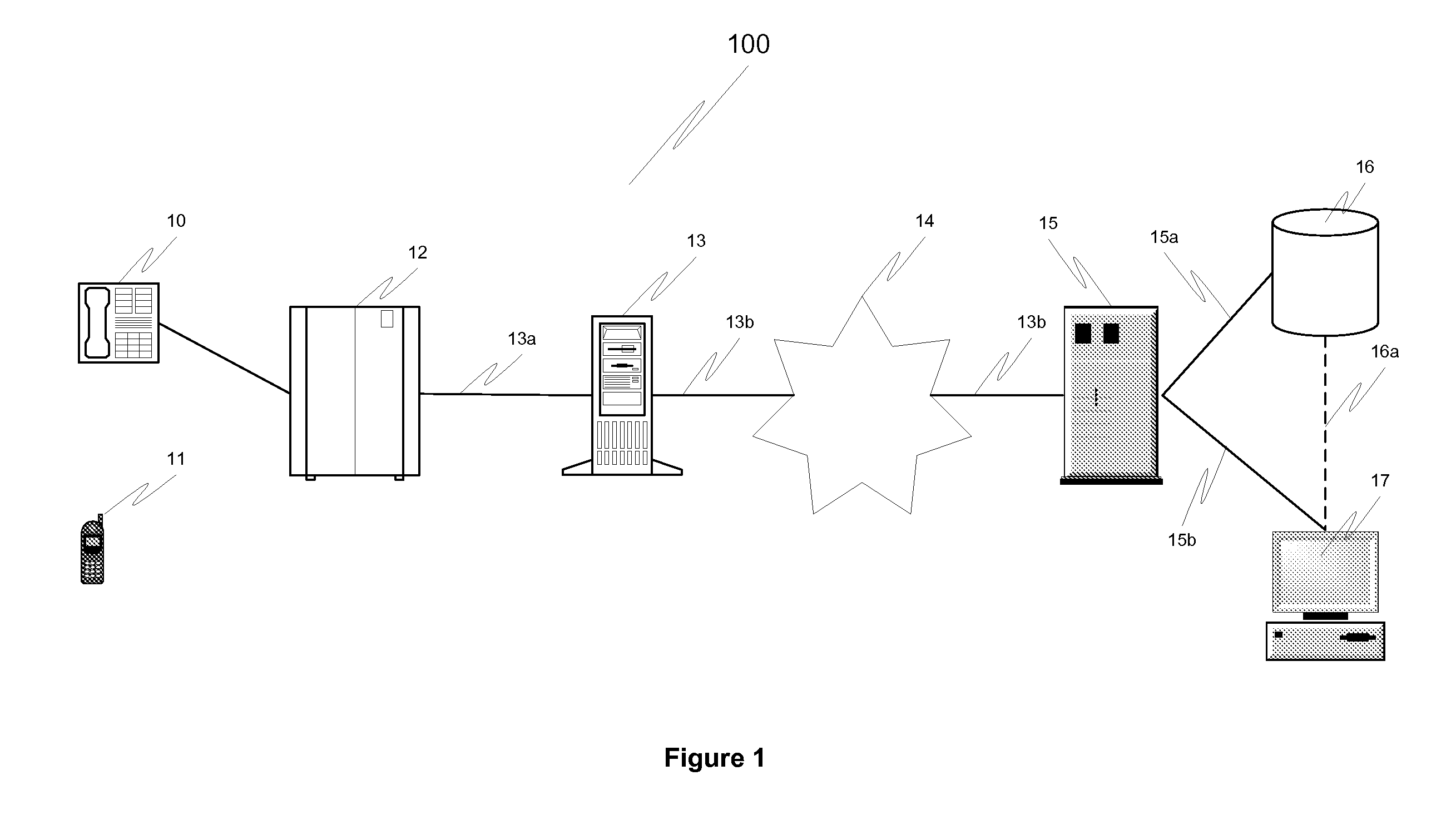

Method and system for performing money transfer transactions

InactiveUS6488203B1Shorten transaction timeImprove accuracyComplete banking machinesFinanceComputer scienceDatabase

A method of performing a send money transfer transaction through a financial services institution includes storing transaction details on a data base, wherein the transaction details include a desired amount of money to be sent; establishing a code that corresponds to the transaction details stored on the data base; entering the code into an electronic transaction fulfillment device in communication with the data base to retrieve the transaction details from the data base; and determining a collect amount based on the transaction details. A system for performing a send money transfer transaction is also disclosed.

Owner:THE WESTERN UNION CO

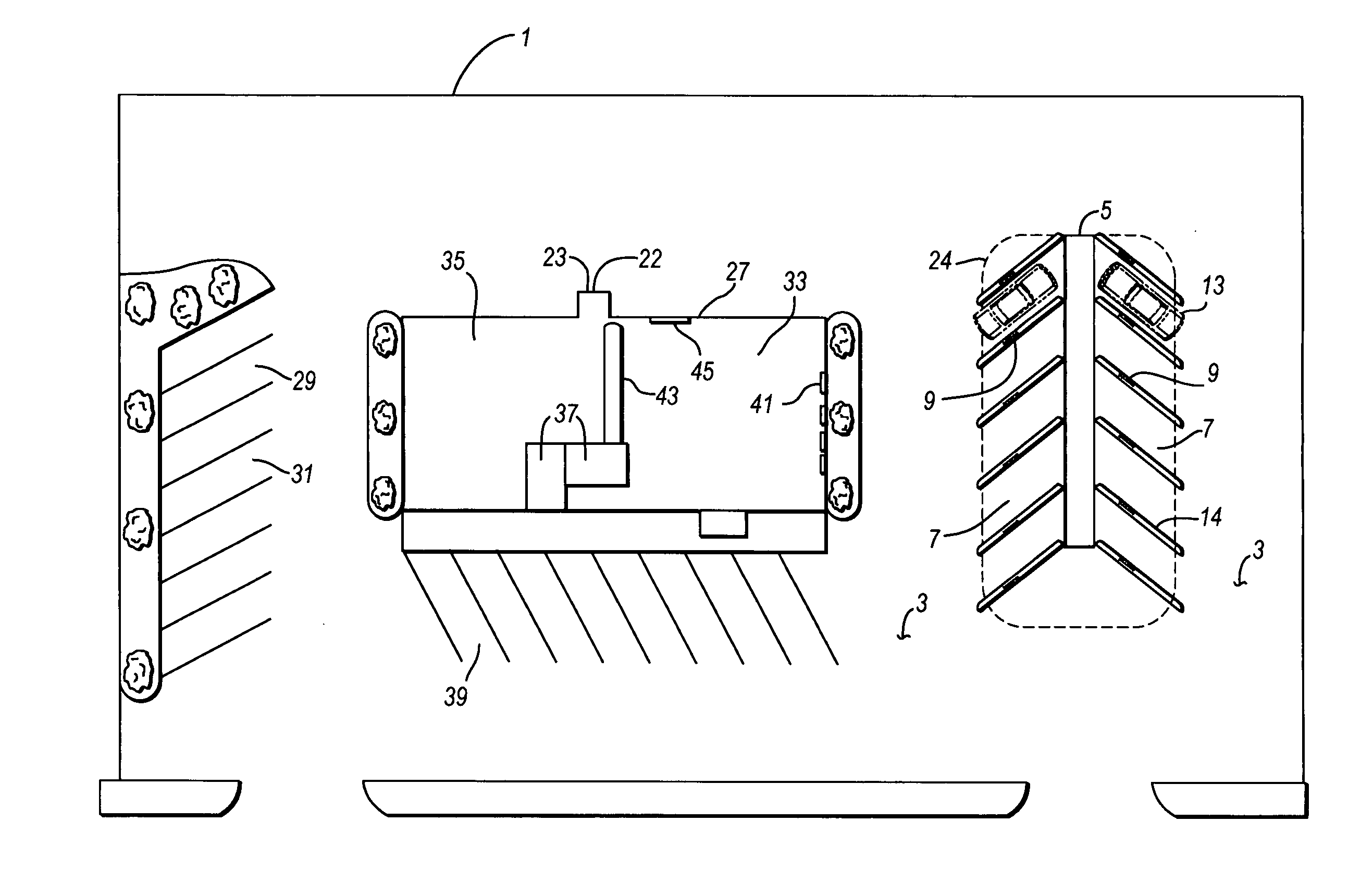

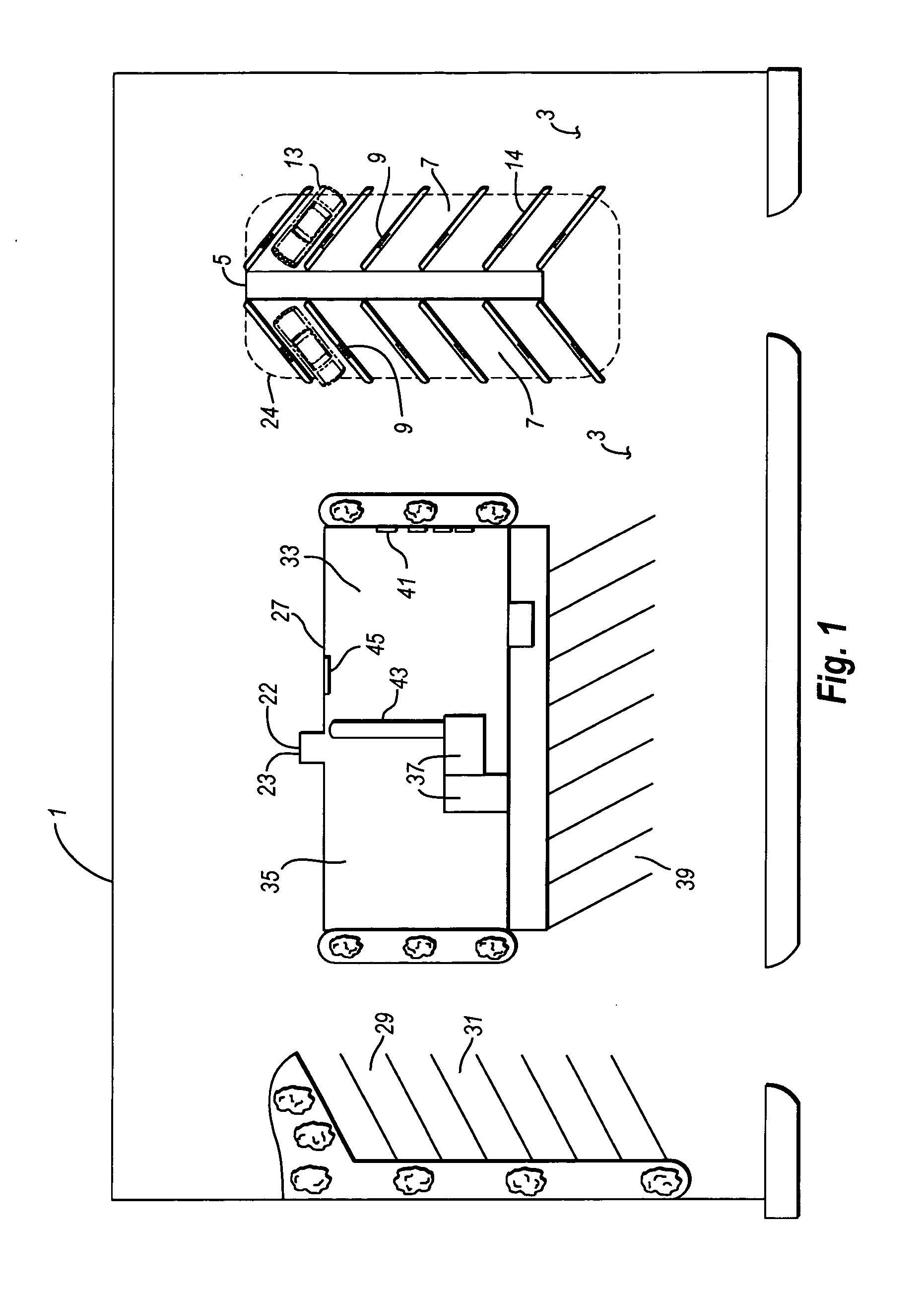

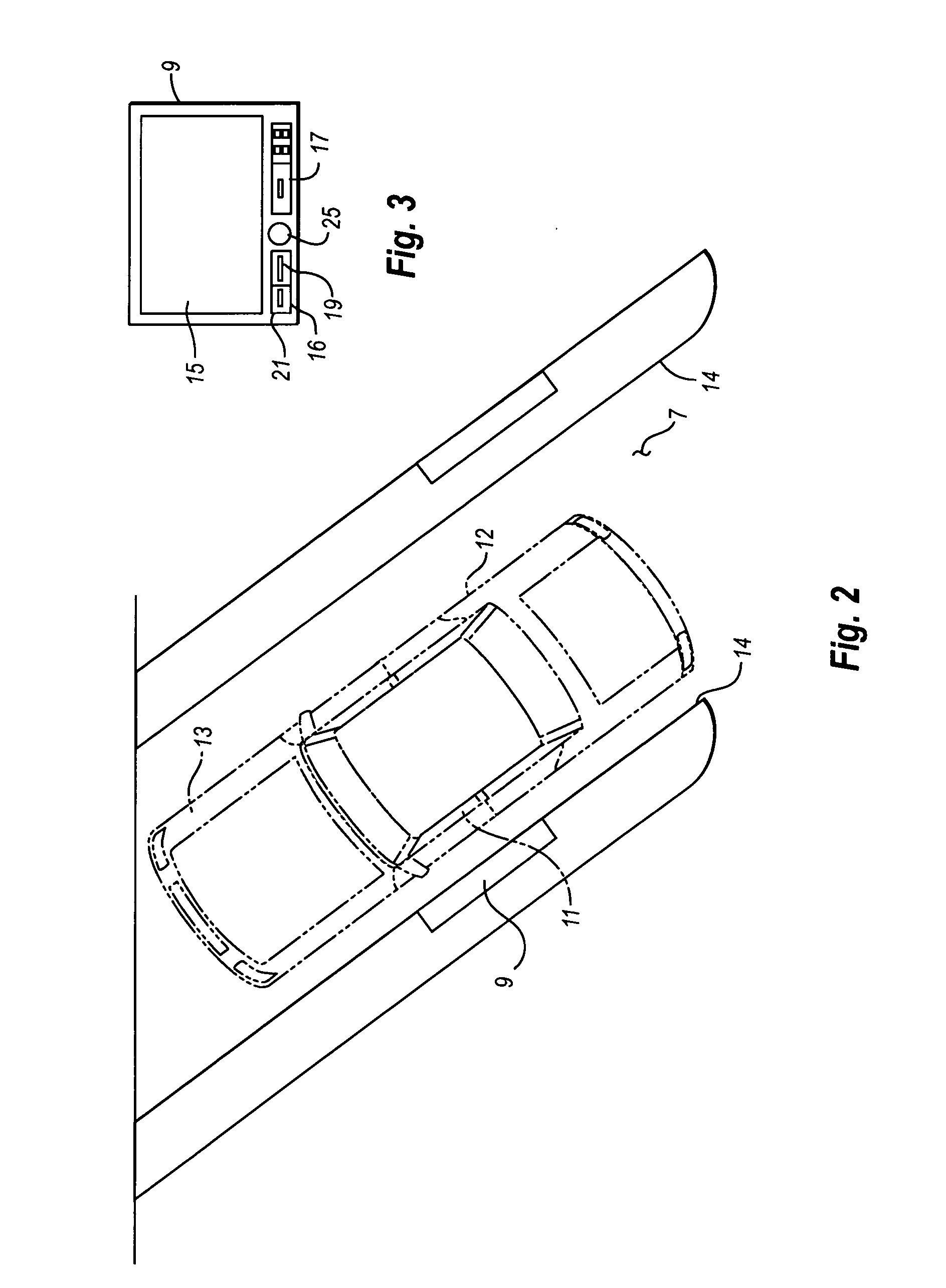

Enhanced fast food restaurant and method of operation

InactiveUS20060218039A1Reduce total transaction timeReduce labor costMarketingItem selectionDisplay device

A fast food restaurant and method of operating a fast food restaurant, the restaurant having an order and staging station for drive through customers. The order and staging station has a plurality of order stalls for customer vehicles, each order stall having an order panel with a menu display and a touch screen or voice or speech activator for self-service menu item selection and order placement. The order panel also has a payment acceptor and an order status reporter. The customer vehicle remains in the order stall until the customer is notified that the order is ready for pickup at a delivery station.

Owner:N P JOHNSON FAMILY PARTNERSHIP

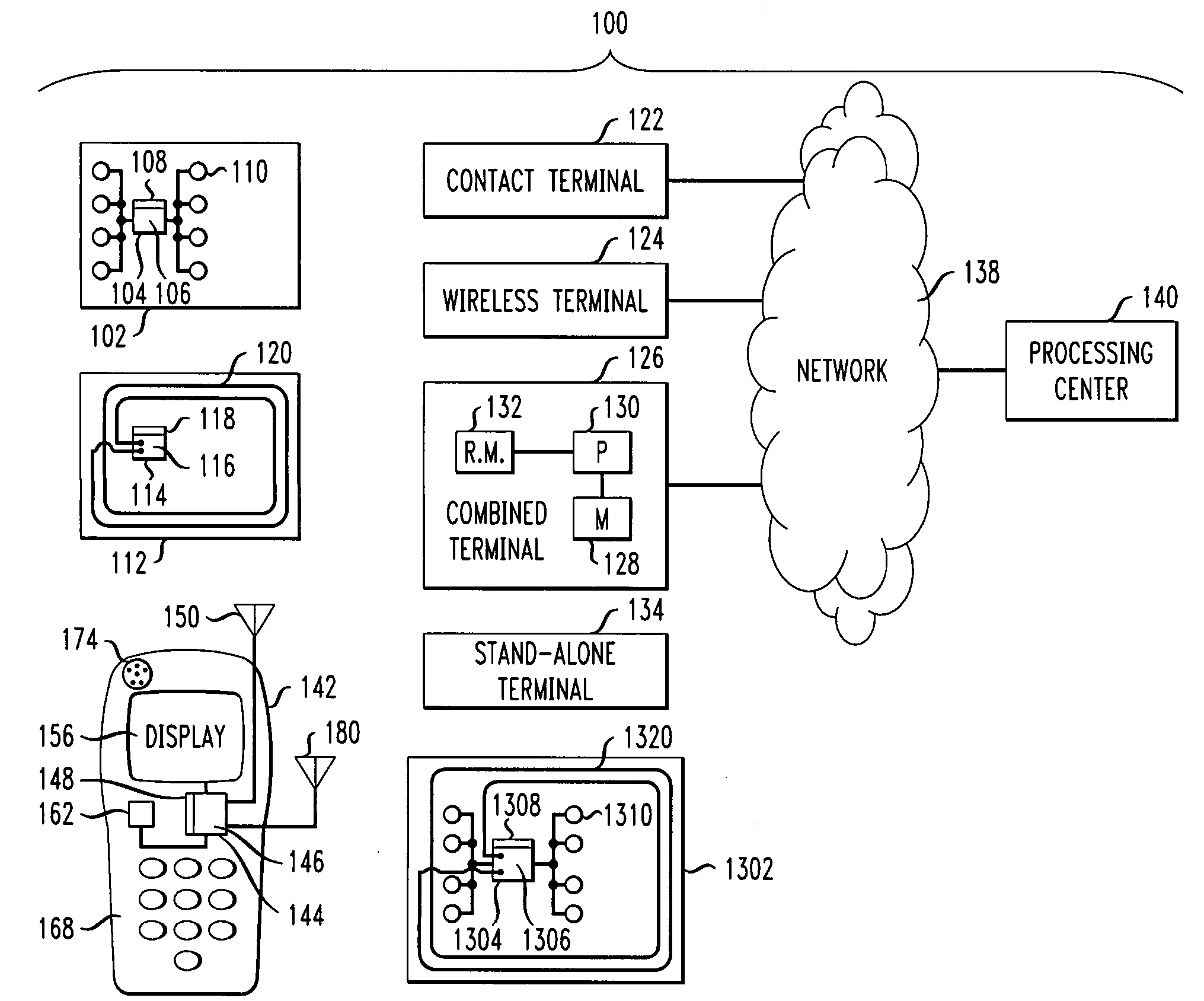

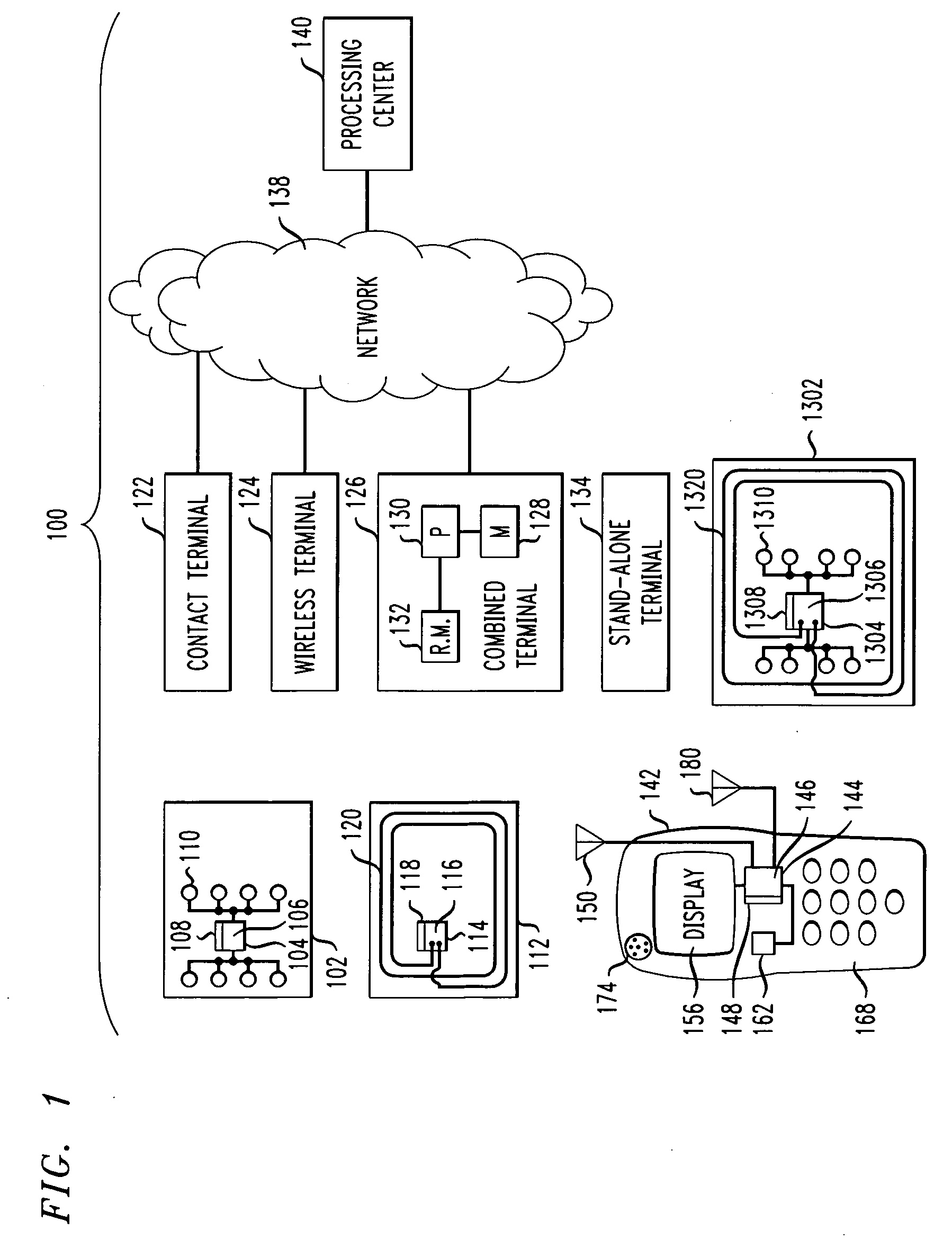

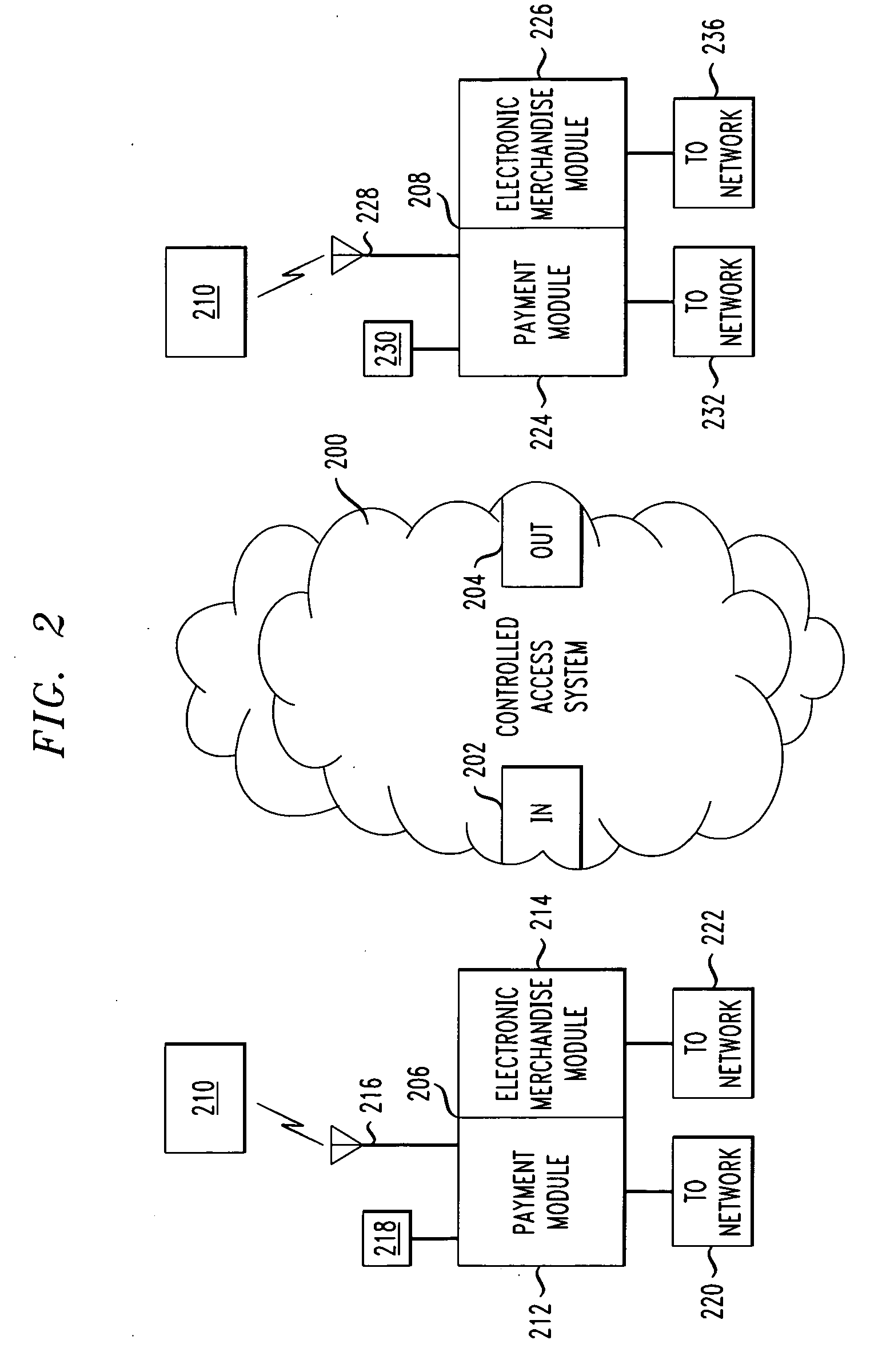

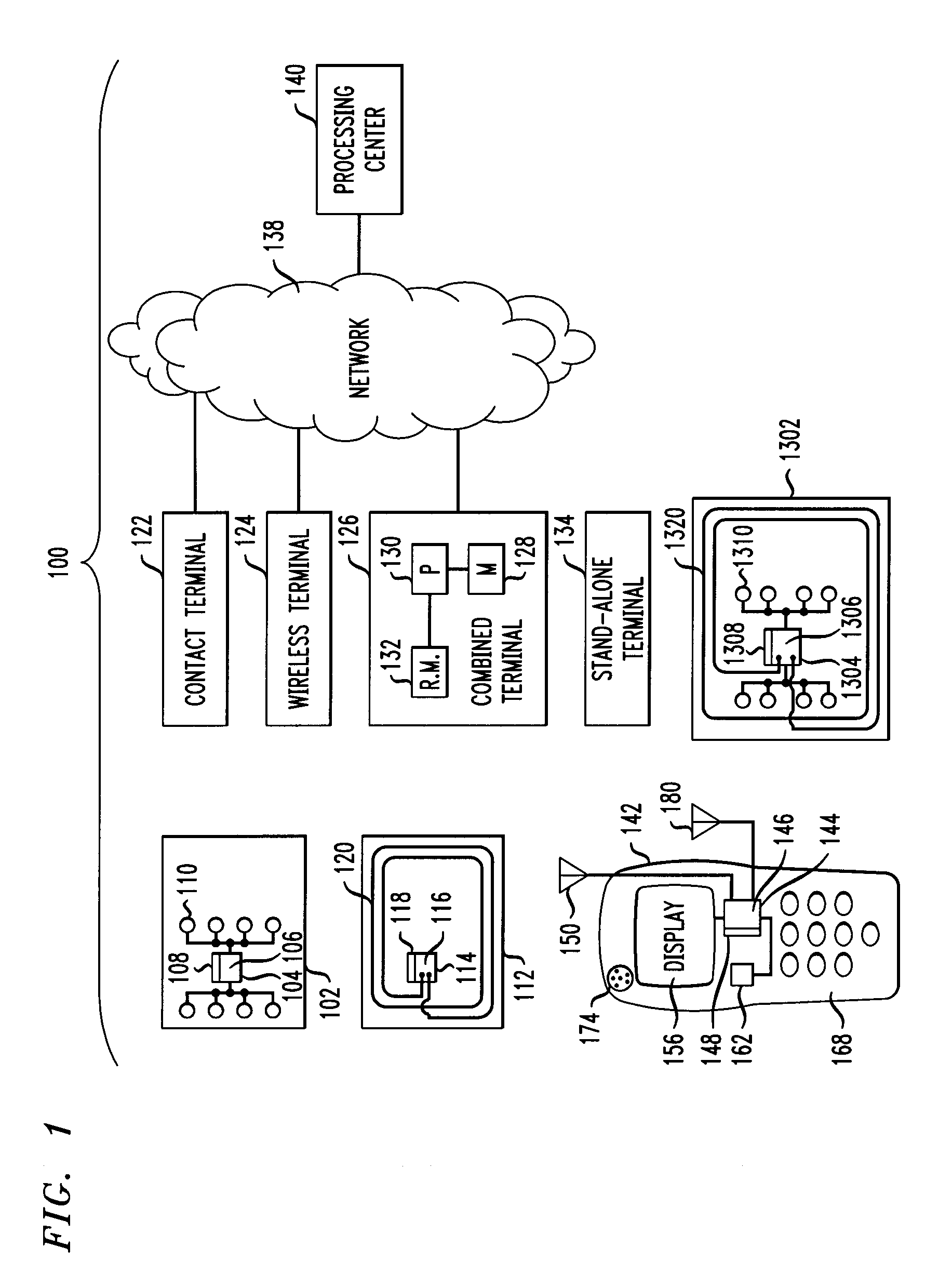

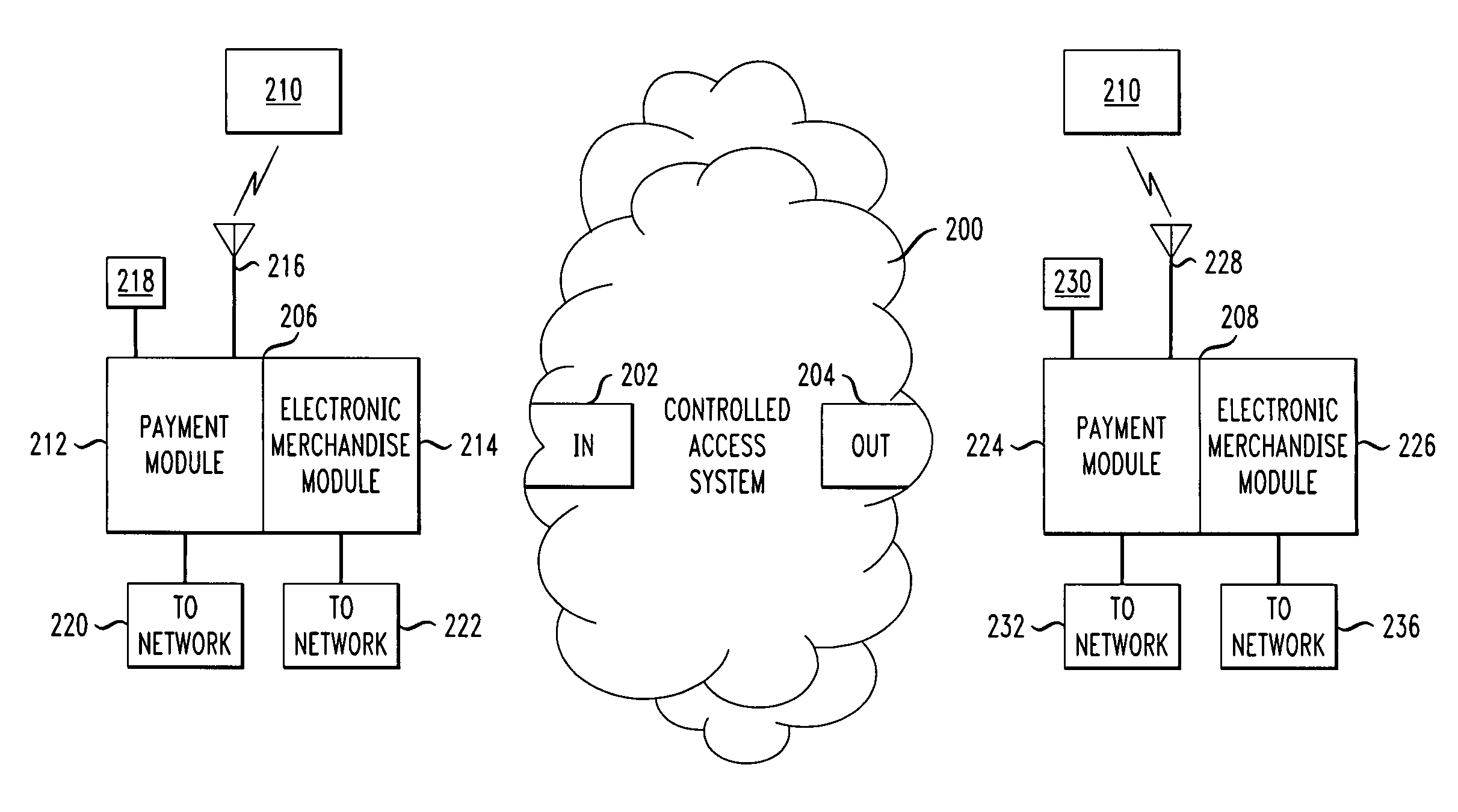

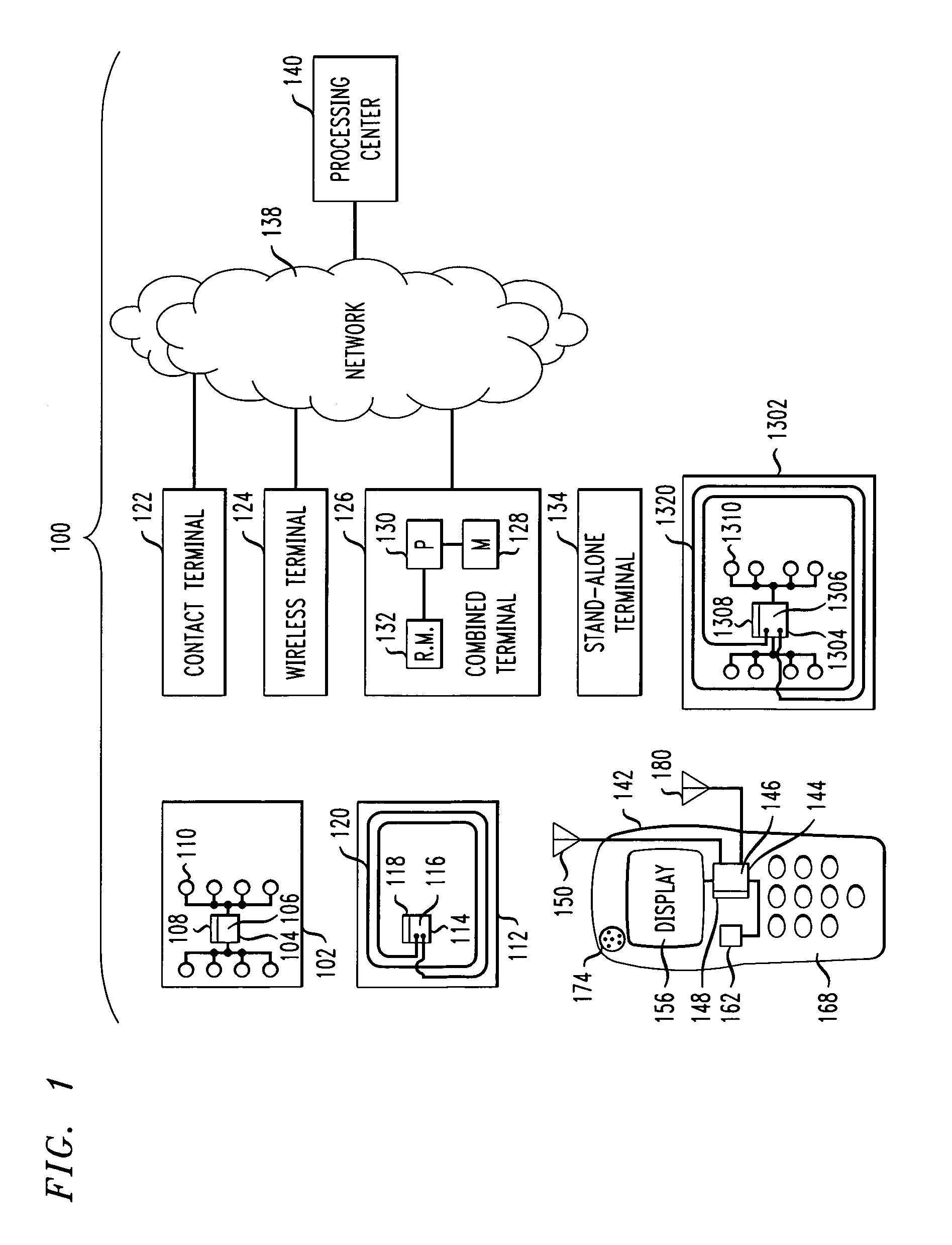

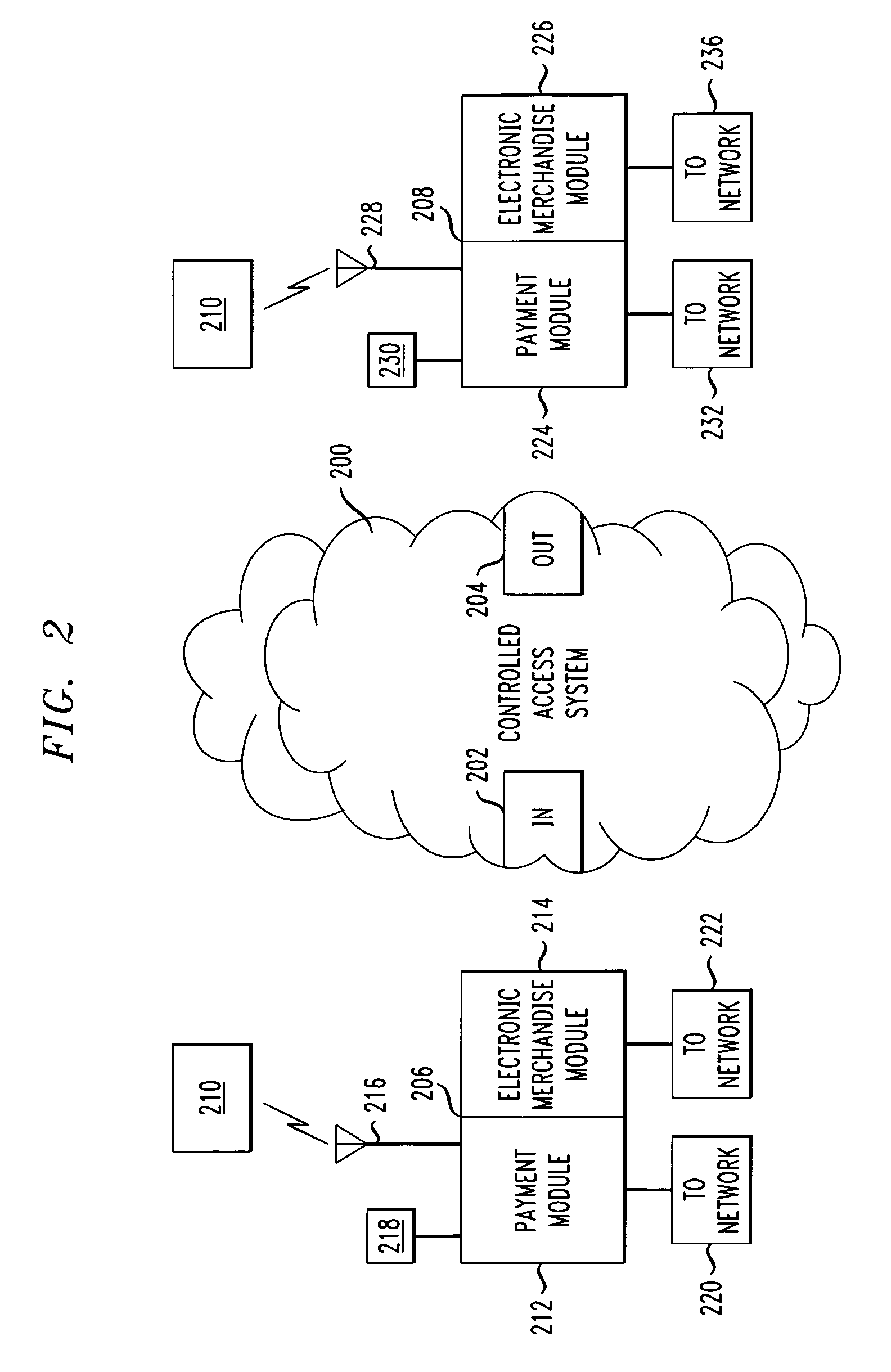

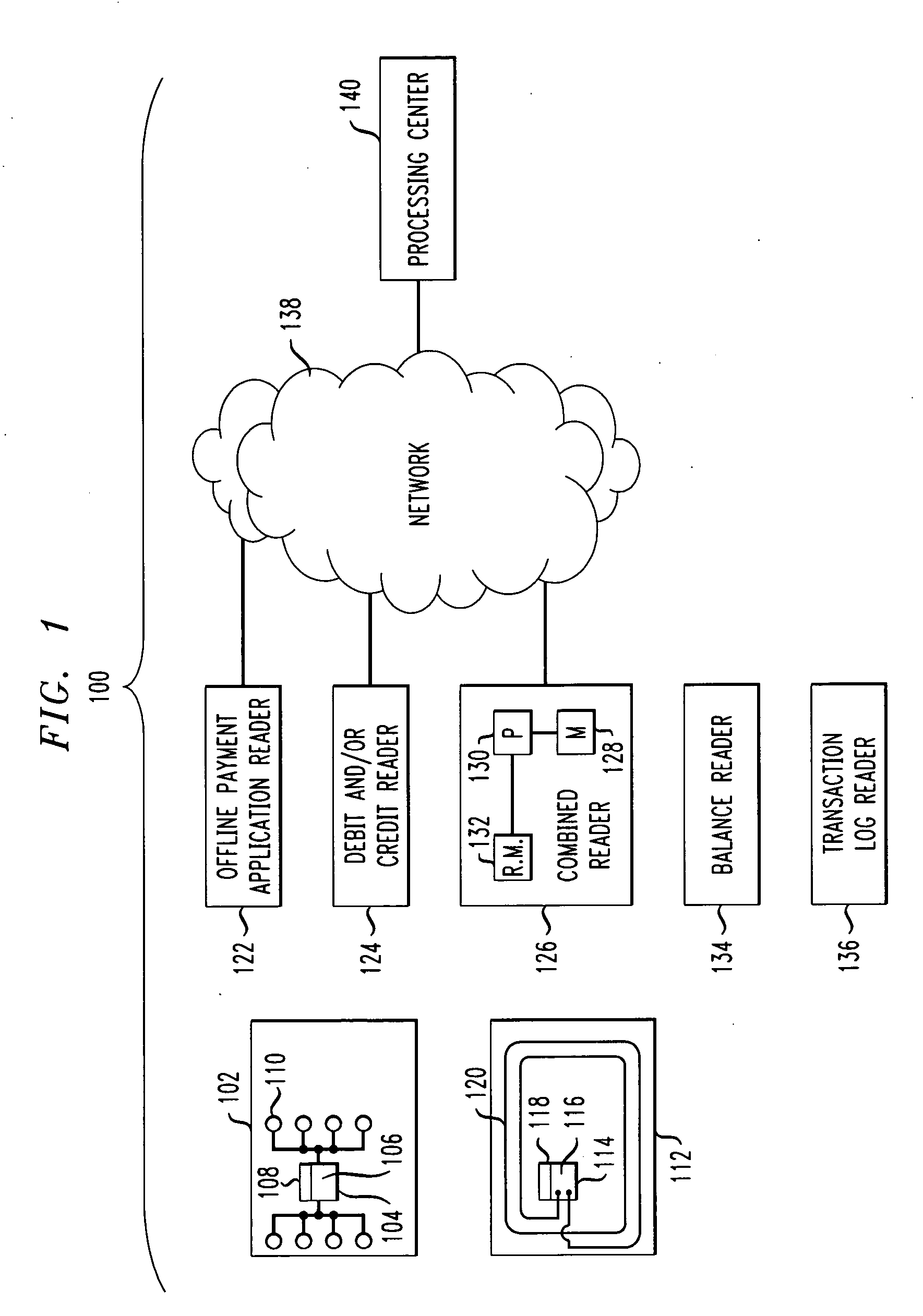

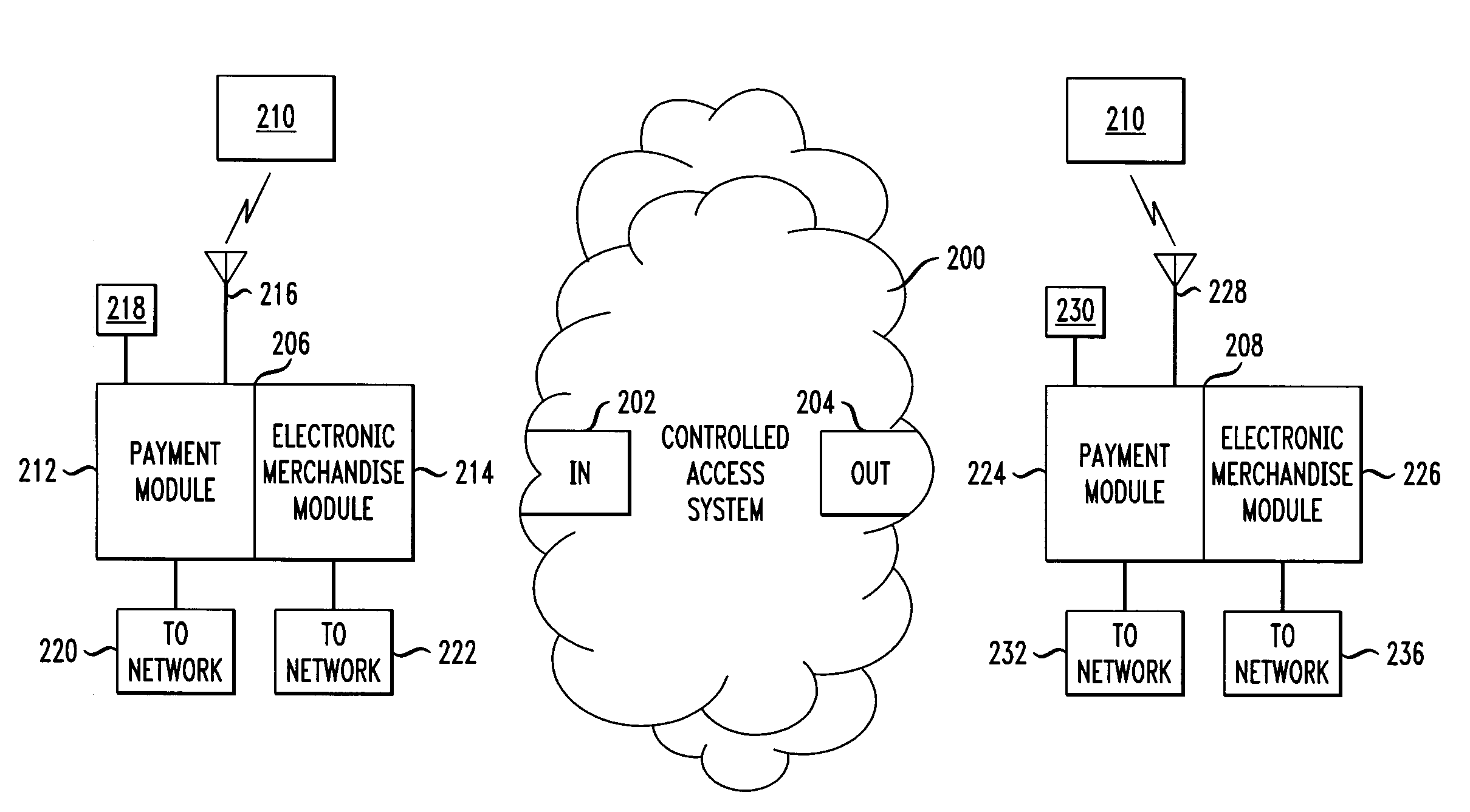

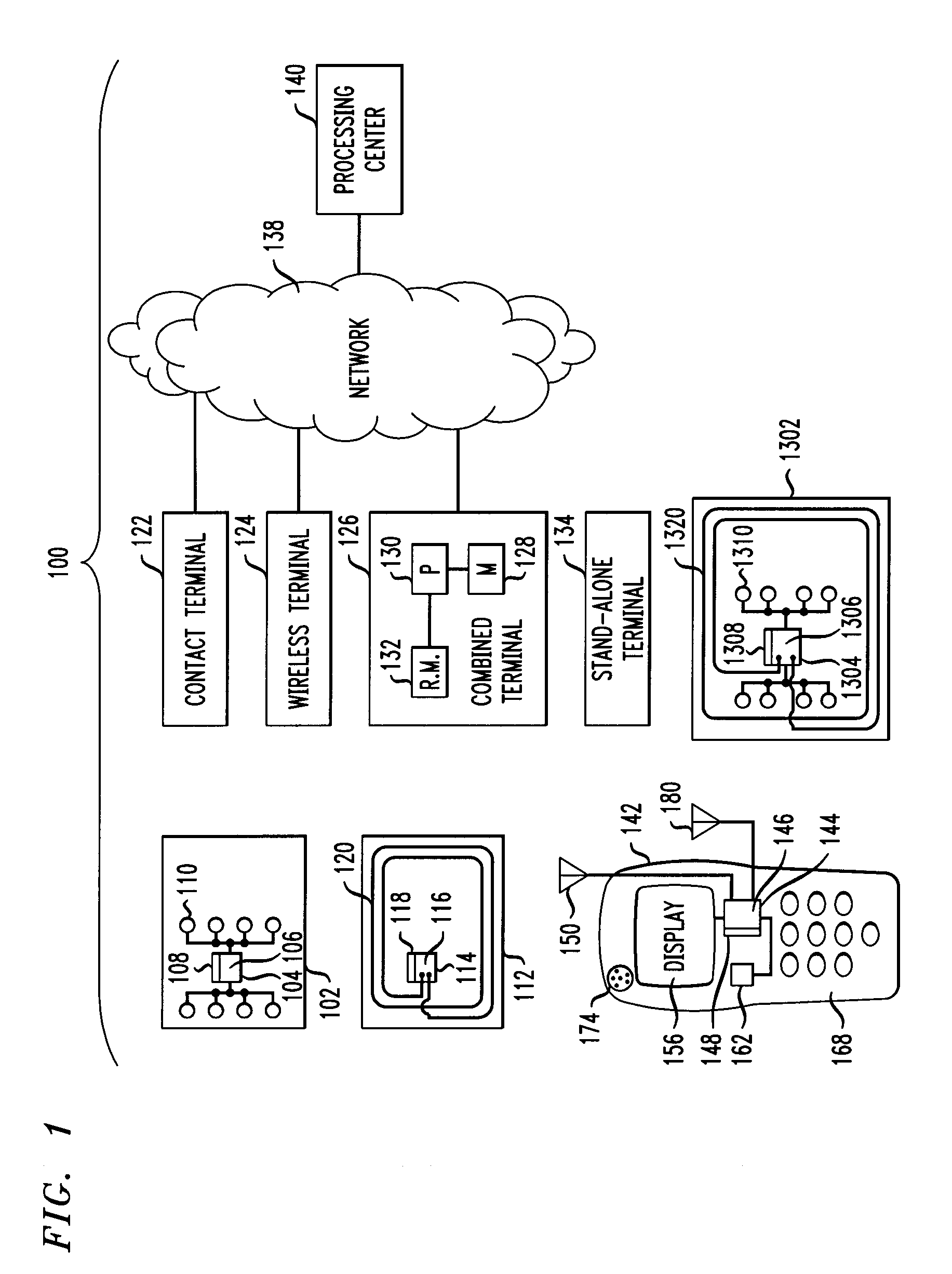

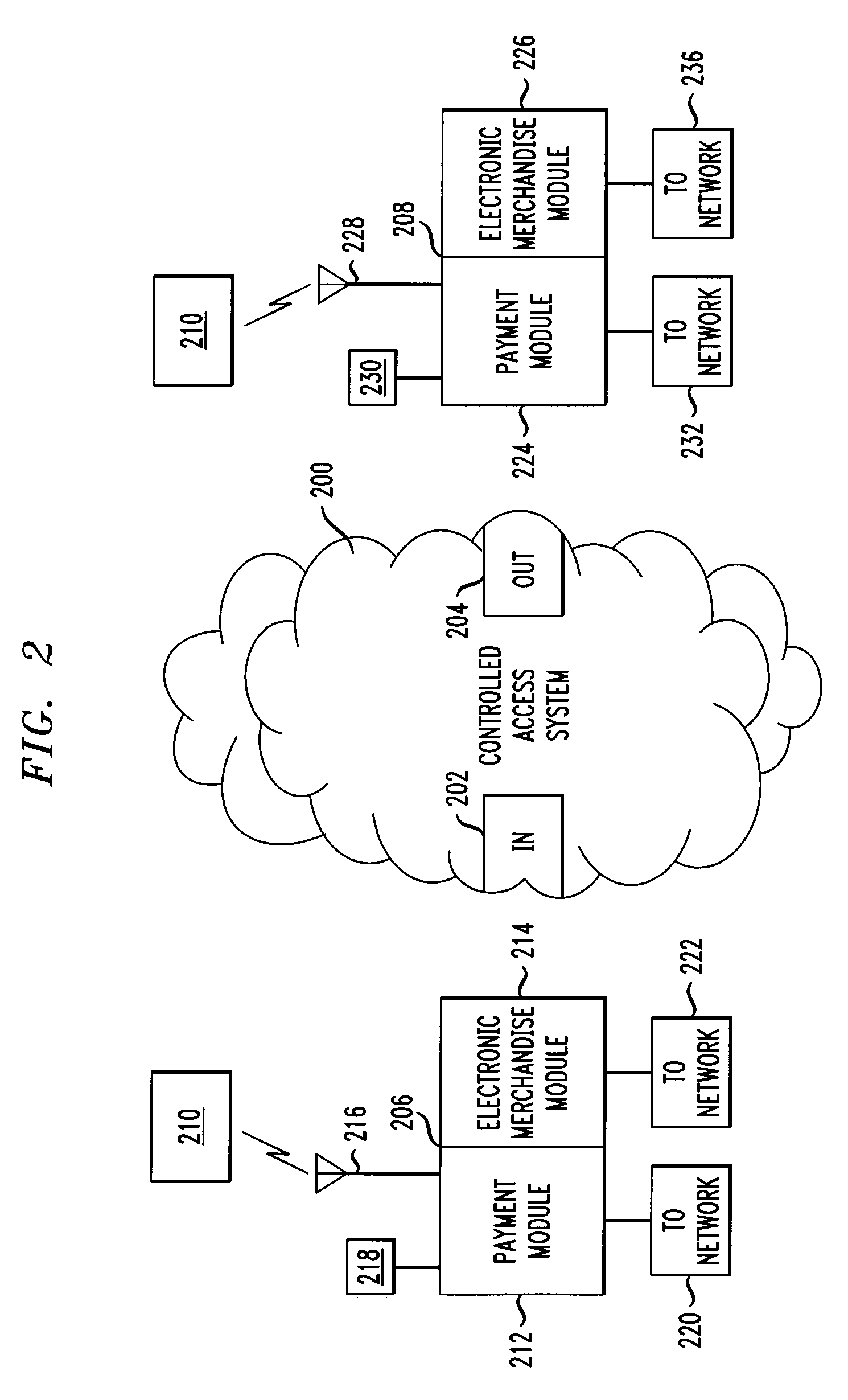

Apparatus and method for integrated payment and electronic merchandise transfer

ActiveUS20070012763A1Efficient combinationEasy transferReservationsCommerceRelevant informationPayment transaction

Payment transactions using a payment infrastructure are efficiently combined with e-merchandise transactions using an e-merchandise infrastructure, while allowing each infrastructure to concentrate on its primary function. An electronic payment device configured according to the payment infrastructure is interrogated by a payment module (also configured according to the payment infrastructure) of a first terminal to obtain financial data. Electronic merchandise-related information is generated by an electronic merchandise module (configured according to the electronic merchandise infrastructure) of the first terminal, and such information is transferred to the electronic payment device within a transaction conducted in accordance with the financial data and the payment infrastructure.

Owner:MASTERCARD INT INC

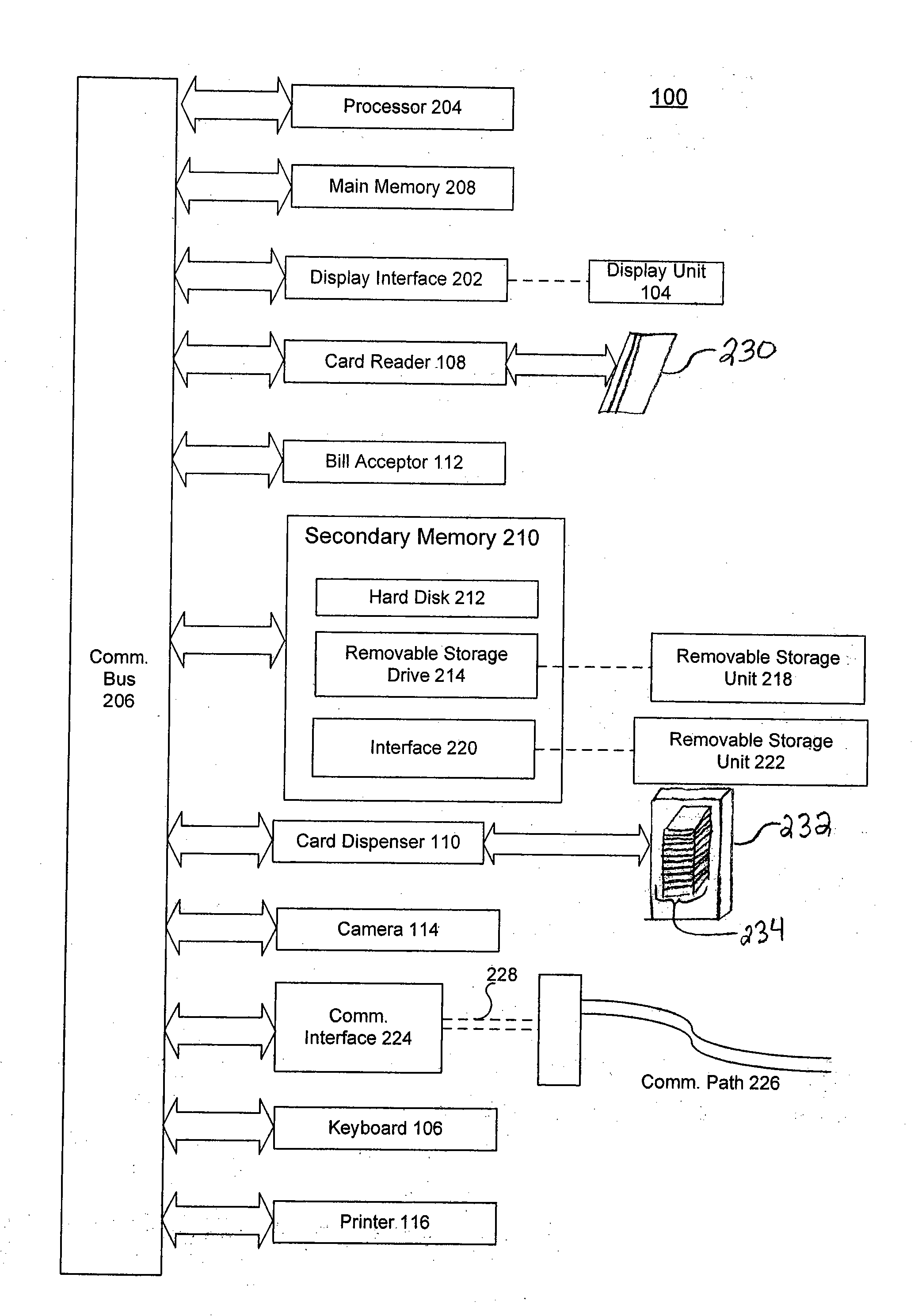

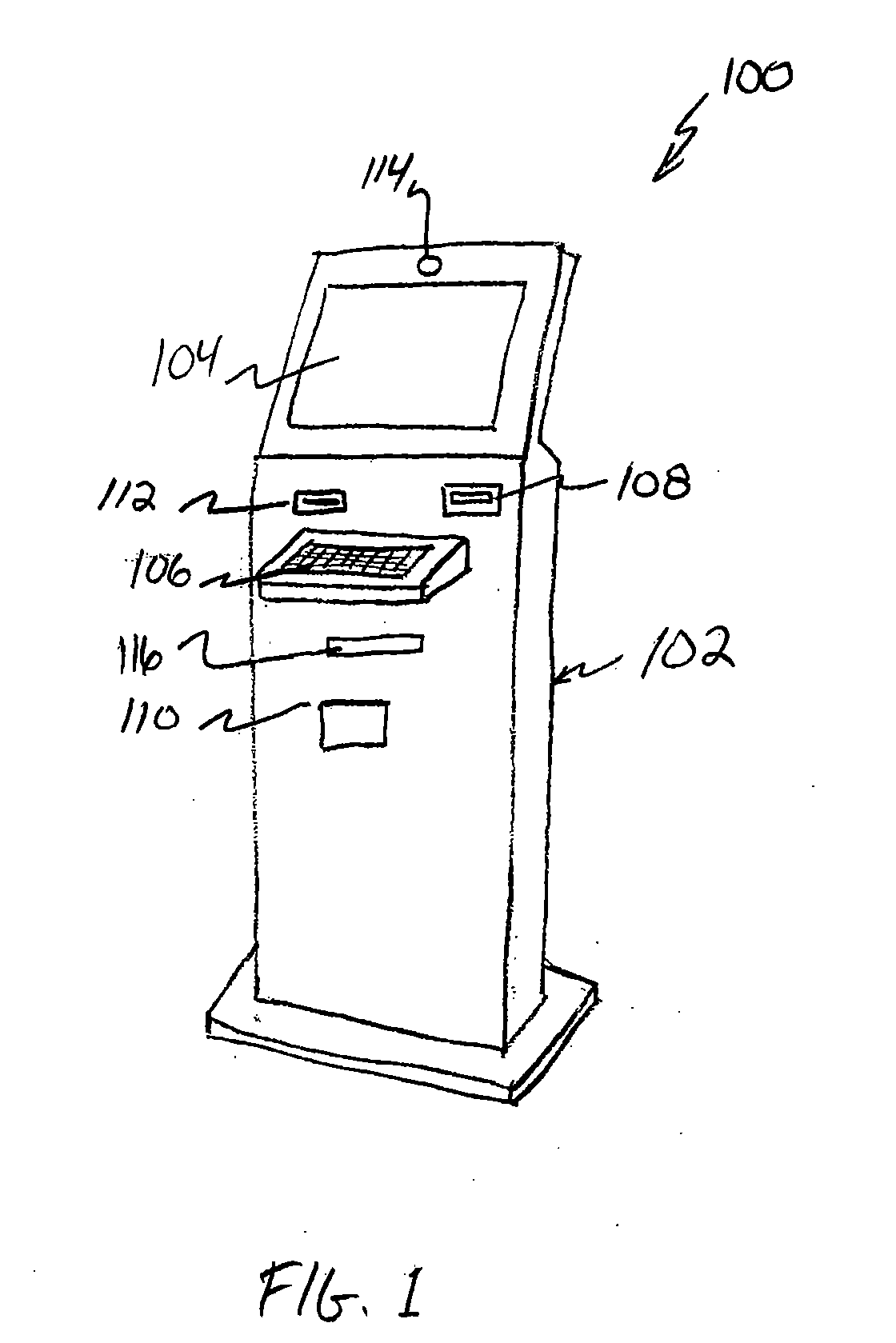

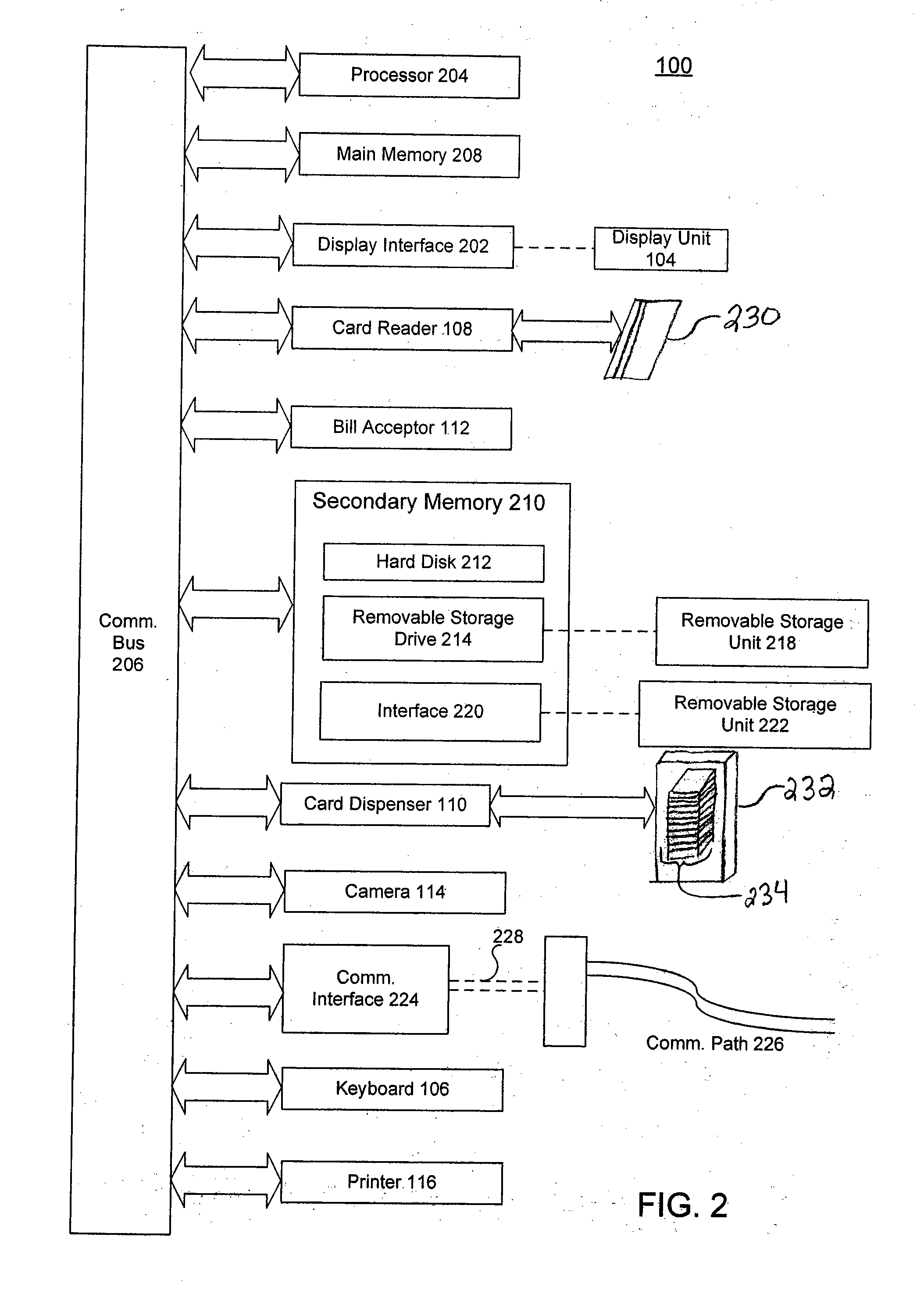

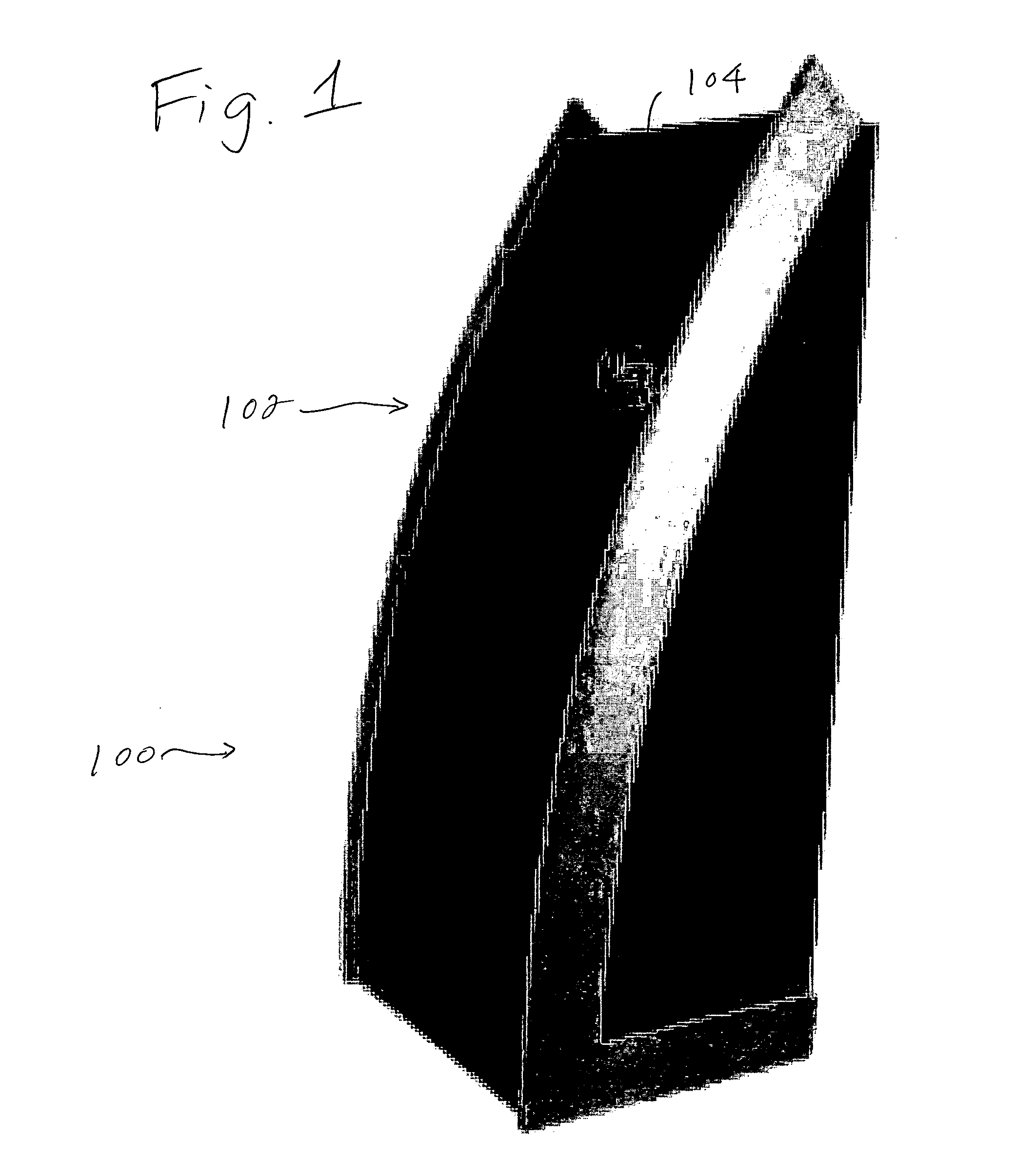

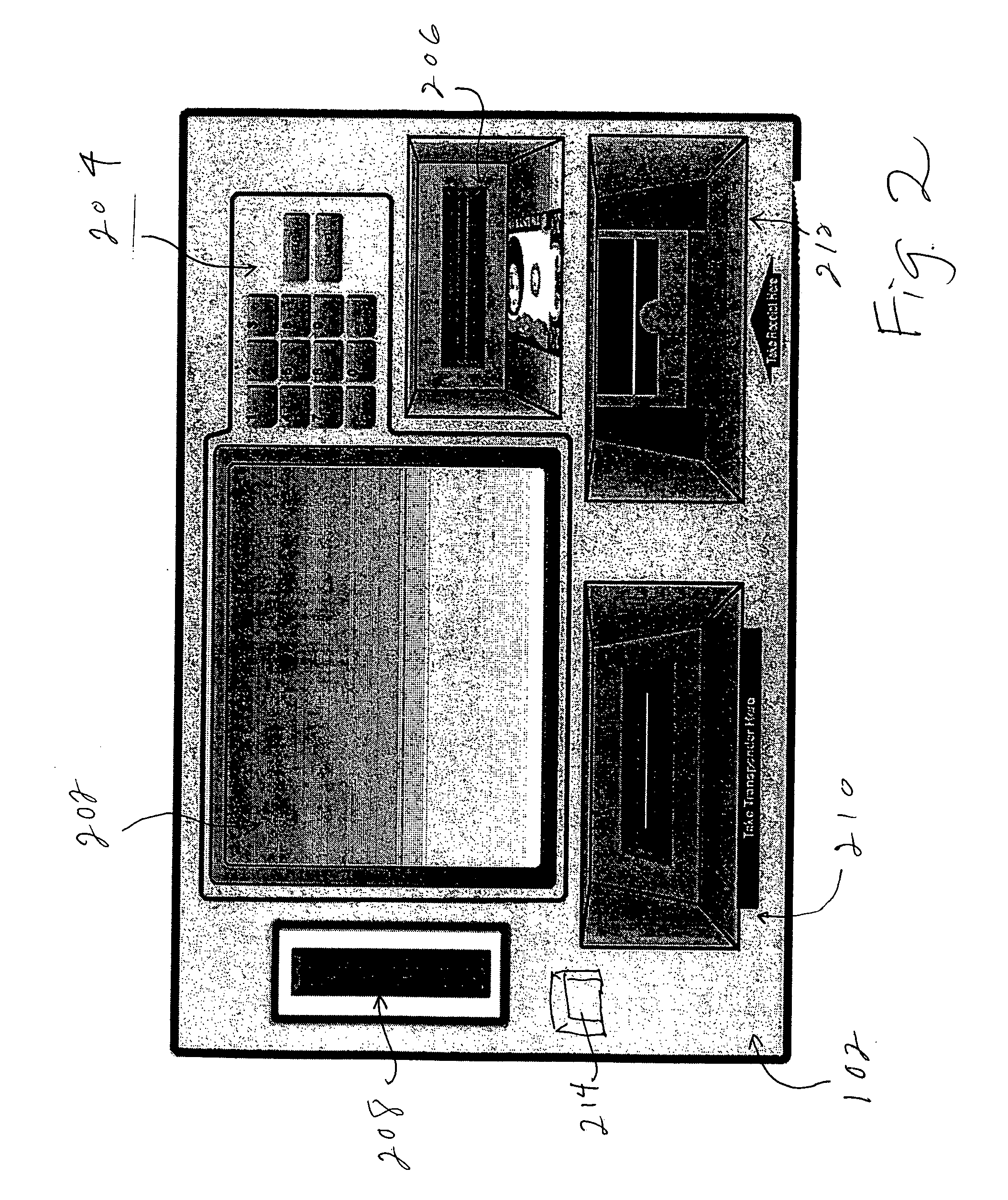

Kiosk and Method for Vending Stored Value Cards

InactiveUS20070272743A1Positive experienceShorten transaction timeComplete banking machinesApparatus for meter-controlled dispensingCredit cardInput selection

A kiosk machine vends stored value cards (i.e., pre-paid and gift cards). The kiosk is self-service and will allow a user to select, purchase and pay for a stored value card without requiring the presence or assistance of a sales clerk. The kiosk can vend one or more cards in a single transaction. The kiosk is a computer-based vending machine having a touch-sensitive video screen and a card reader. The touch screen provides a user interface for a user to receive information and provide input selections. The card reader can be used to read a transaction card (e.g., an American Express card or credit card) to facilitate payment for the stored value card(s) being purchased. The vending method comprises: providing a kiosk having a user interface; receiving, via the user interface, a request to purchase a stored value card, receiving payment for the purchase; determining a card number associated with a selected card; activating the selected card to produce an activated stored value card in the card denomination; and dispensing the activated stored value card. A user purchasing a stored value card can select a type of stored value card, wherein the type is selected from the group consisting of an open card and a closed card. The closed card can be of the type usable only in a shopping center where the kiosk is physically located. The user can further select a card denomination. The method further allows a user to check a card balance for a stored value card.

Owner:LIBERTY PEAK VENTURES LLC

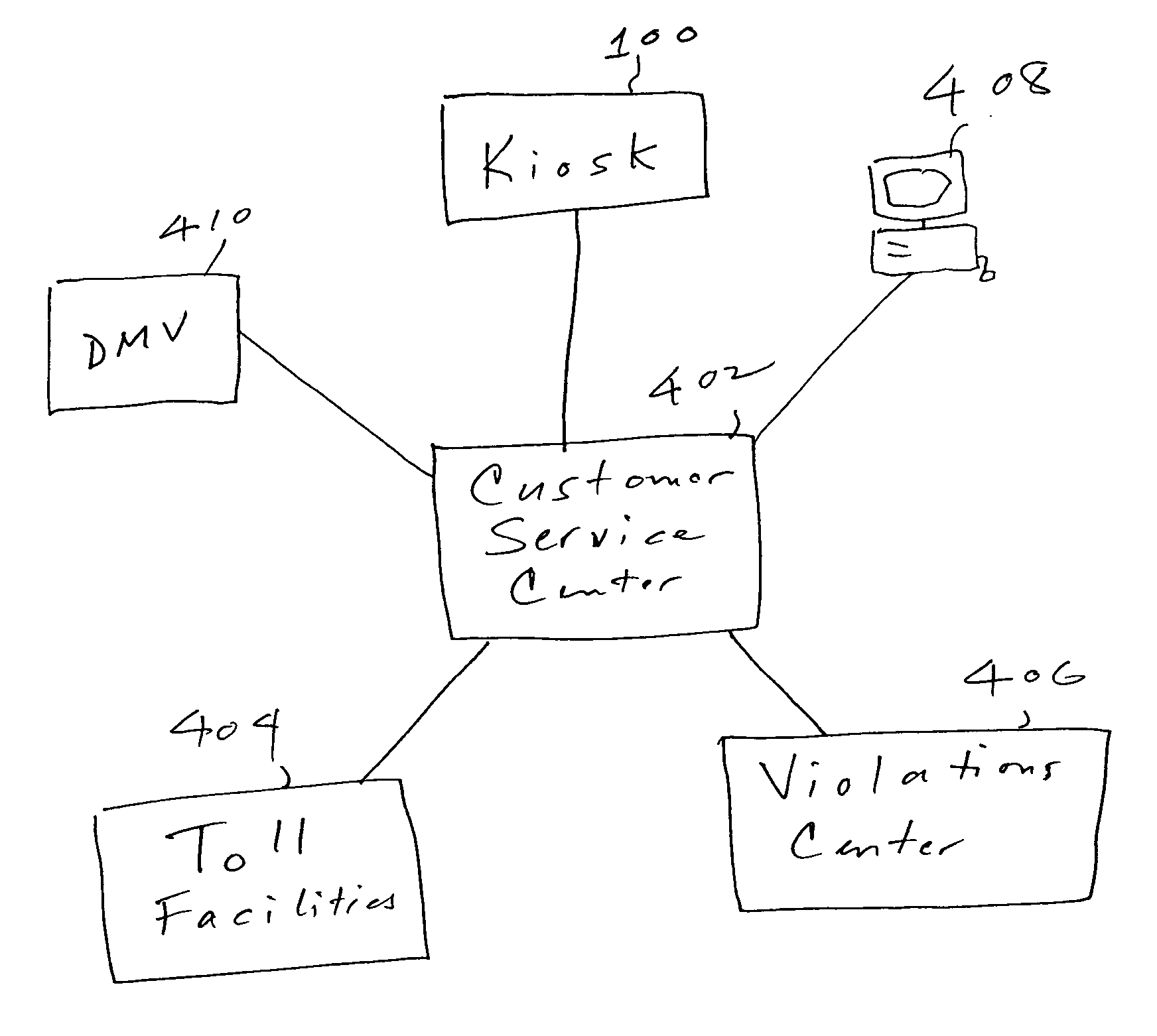

Self-service electronic toll collection unit and system

ActiveUS20050010478A1Efficient formReduce their current operating costTicket-issuing apparatusCredit registering devices actuationServices computingEngineering

A self-service vending unit allows a potential user of a toll transponder to buy the transponder without having to visit a customer-service facility. The vending unit automatically accepts payment, such as cash or a credit or debit card, and issues the transponder with a paid value. The vending unit communicates with a customer-service computer through a TCP / IP connection and allows the user to top off the value on the transponder and otherwise to manage the account.

Owner:AMTECH SYST

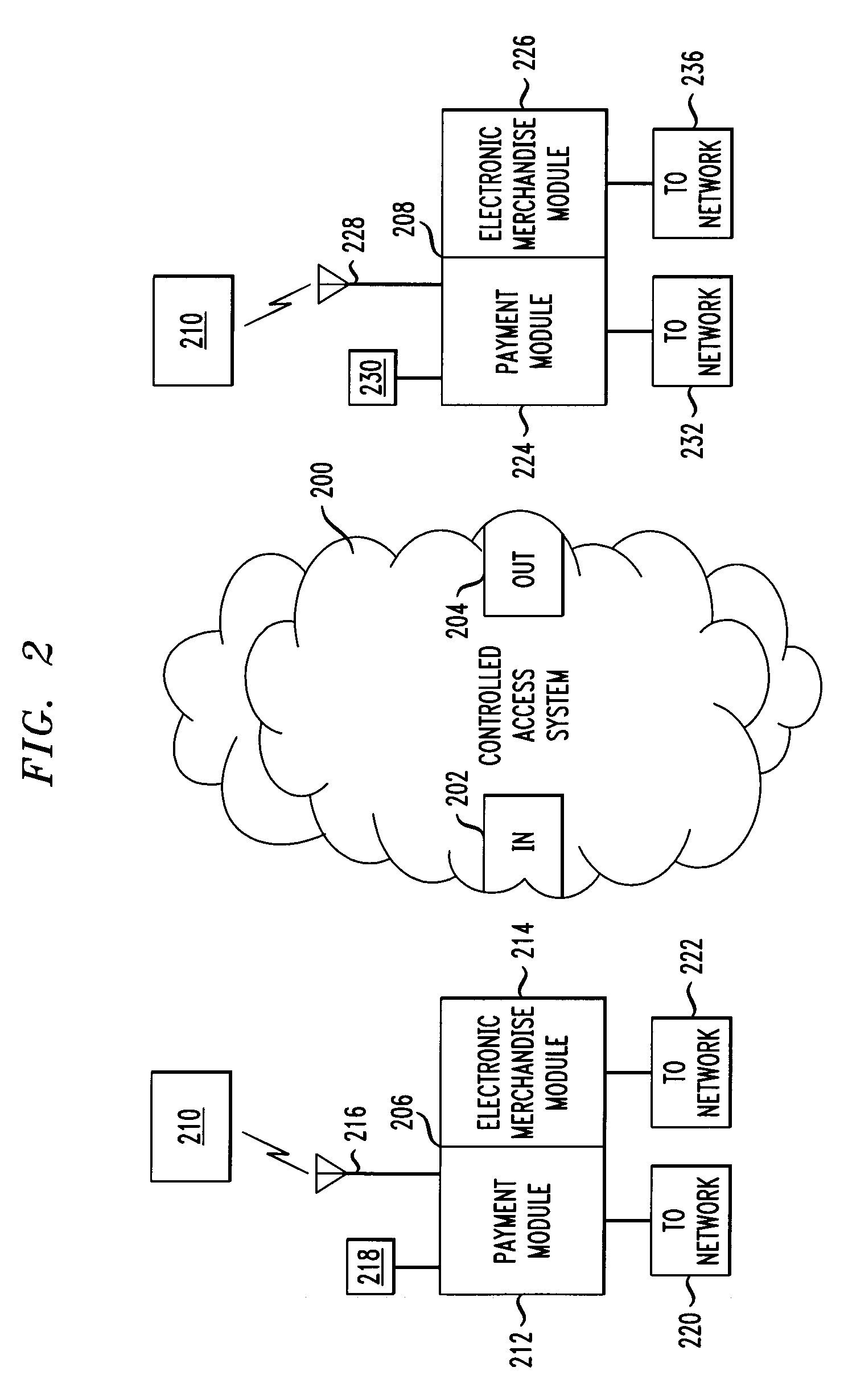

Apparatus and method for integrated payment and electronic merchandise transfer

ActiveUS20100252624A1Efficient combinationEasy transferTransportation facility accessFinanceRelevant informationSummary data

Interrogation of an electronic device by a first terminal is facilitated, to obtain an account number associated with the electronic device. The electronic device is configured according to a payment specification. The first terminal has a first terminal payment module configured according to the payment specification and a first terminal electronic merchandise module configured according to the electronic merchandise infrastructure and coupled to the first terminal payment module to permit transfer of non-payment e-merchandise related information from the first terminal electronic merchandise module to the first terminal payment module. The interrogation of the electronic device is performed by the first terminal payment module. Generation of non-payment e-merchandise related information by the first terminal electronic merchandise module is facilitated. Transfer of the non-payment e-merchandise related information from the first terminal electronic merchandise module to the electronic device via the first terminal payment module, within a transaction between the electronic device and the first terminal payment module that is conducted in accordance with the payment specification, is also facilitated. The non-payment e-merchandise related information is stored on the electronic device in accordance with the payment specification. The electronic device and the first terminal independently calculate a summary data item. The first terminal calculates a first message authentication code based on the non-payment e-merchandise related information and a terminal-calculated value of the summary data item. The non-payment e-merchandise related information is stored on the electronic device together with an electronic device-calculated value of the summary data item and the first message authentication code.

Owner:MASTERCARD INT INC

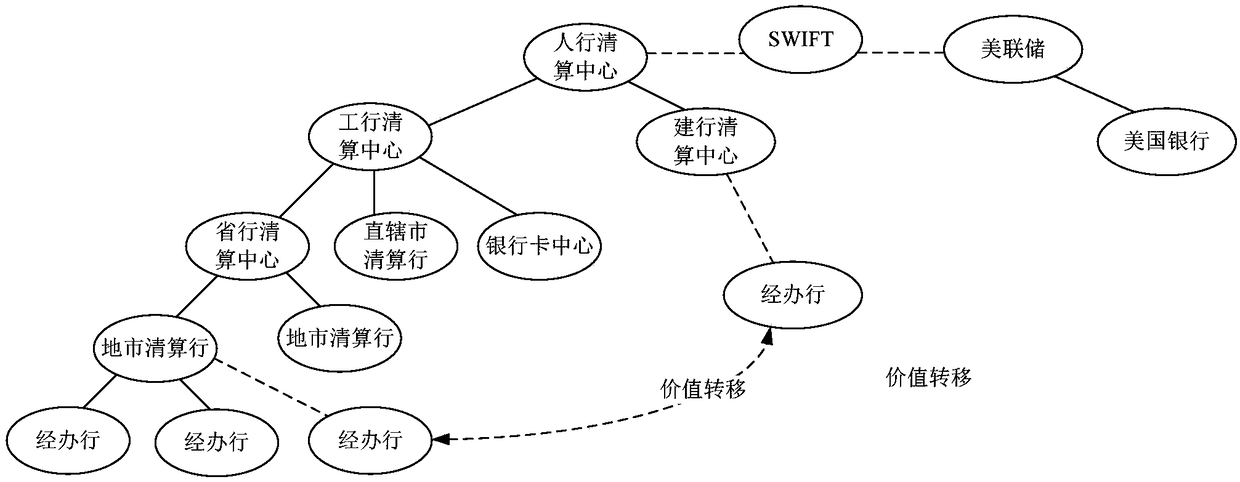

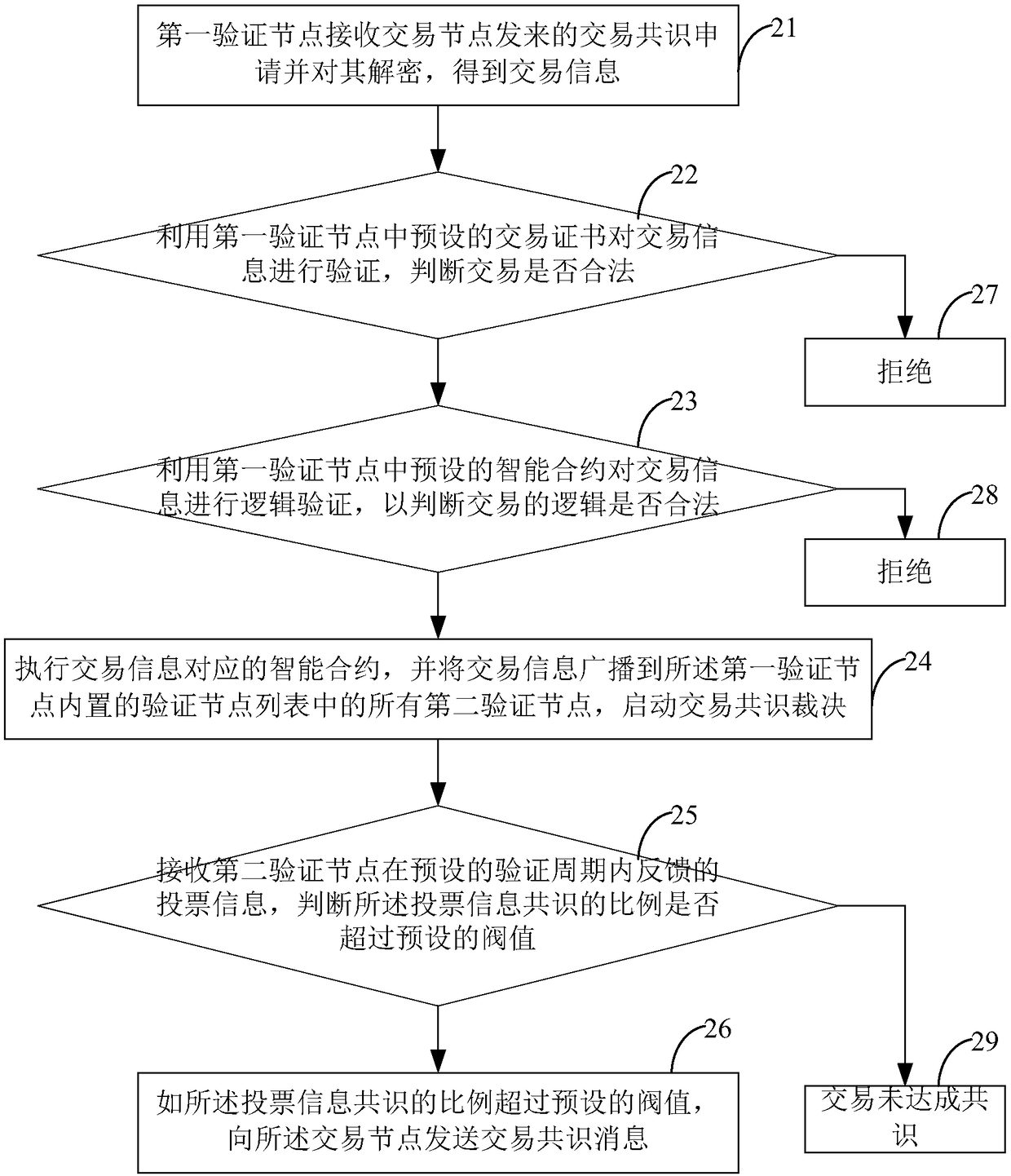

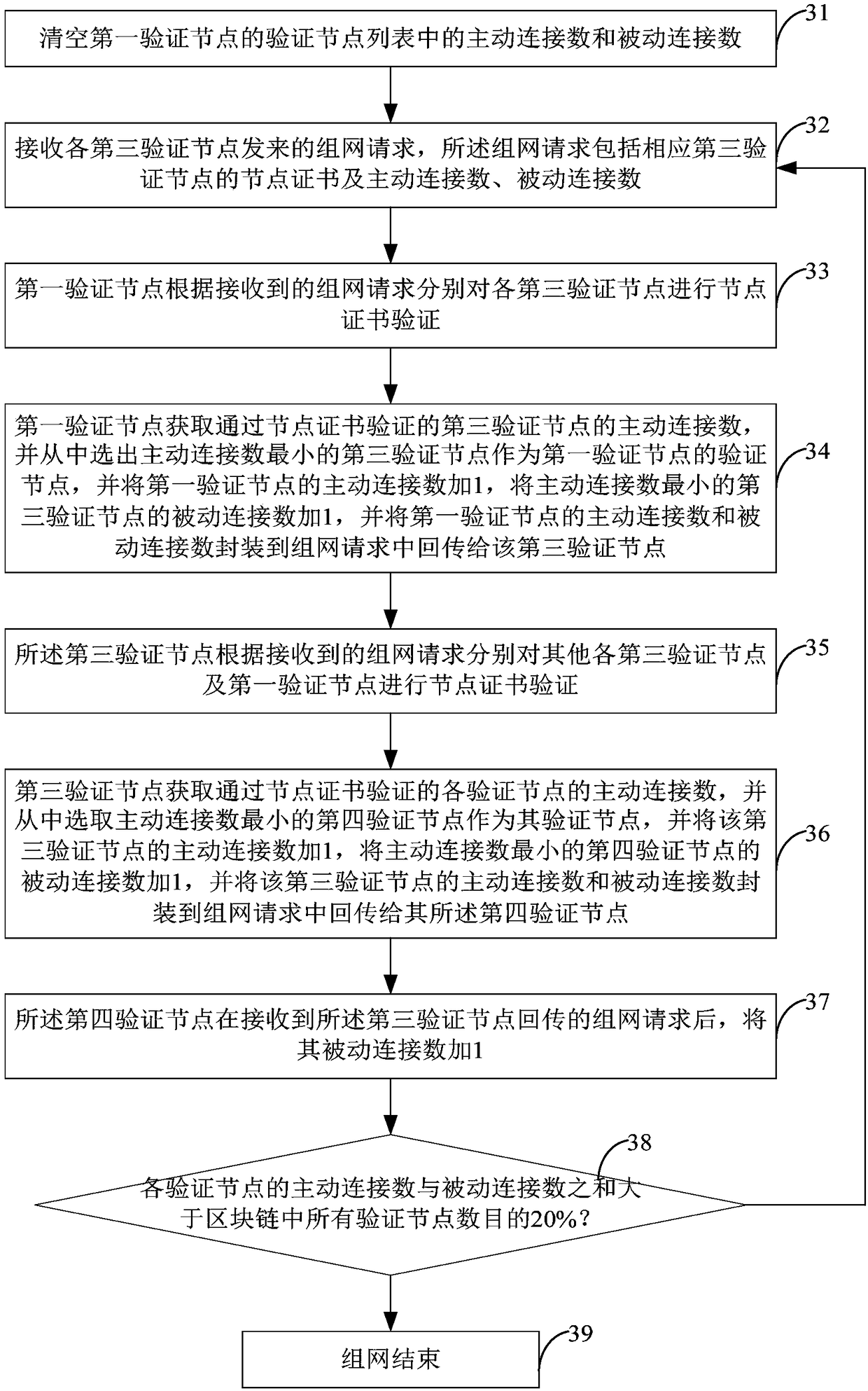

Block-chain-based financial product transaction consensus method, node and system

The invention provides a block-chain-based financial product transaction consensus method, node and system. The method comprises: a first verification node receives a transaction consensus applicationsent by a transaction node and decrypts the transaction consensus application to obtain transaction information; the transaction certificate is verified by using a transaction certificate preset in the first verification node to determine whether transaction is legal or not; if so, the transaction information is logically verified by using a smart contract preset in the first verification node and whether the transaction logic is legal is determined; if so, the smart contract corresponding to the transaction information is executed, the transaction information is broadcasted to all second verification nodes in a built-in verification node list of the first verification node and a transaction consensus decision is initiated; voting information fed back by the second verification nodes within a preset verification cycle is received and whether the proportion of the consensus of the voting information exceeds a preset threshold is determined; and if so, a transaction consensus message issent to the transaction node.

Owner:INDUSTRIAL AND COMMERCIAL BANK OF CHINA

Apparatus and method for integrated payment and electronic merchandise transfer

ActiveUS7374082B2Risk minimizationReduce complexityReservationsCommerceRelevant informationPayment transaction

Payment transactions using a payment infrastructure are efficiently combined with e-merchandise transactions using an e-merchandise infrastructure, while allowing each infrastructure to concentrate on its primary function. An electronic payment device configured according to the payment infrastructure is interrogated by a payment module (also configured according to the payment infrastructure) of a first terminal to obtain financial data. Electronic merchandise-related information is generated by an electronic merchandise module (configured according to the electronic merchandise infrastructure) of the first terminal, and such information is transferred to the electronic payment device within a transaction conducted in accordance with the financial data and the payment infrastructure.

Owner:MASTERCARD INT INC

Method of playing a wagering game

InactiveUS6827348B1Shorten transaction timeReduce in quantityBoard gamesCard gamesPlaying cardArtificial intelligence

A playing card wagering game method that involves each player wagering an initial blind bet against the dealer and an optional premium odds side bet for premium dealt hands having a rank equal to a pair of aces or higher rank within the first five cards players are dealt, resulting in a payout of six to one. Each player and the dealer are dealt five cards in succession face down. Two common cards are dealt face down in succession. Dealer turns dealer's dealt hand face up to reveal rank of cards. Players elect to hold on their dealt hands for higher odds payout of two to one or place a draw bet equal to their initial bet to include the use of the two common cards in play to improve their hands, resulting in payouts of even odds for using the first common card and one half odds, one for two, for using the second common card. Dealer turns first and second common cards face up. Dealer always uses dealer's dealt hand and both common cards to make highest ranked poker hand possible. Dealer turns players' cards face up declares rank of all hands, and resolves all wagers.

Owner:MITCHELL TYRONE EMMITT

Anti-tear protection for smart card transactions

InactiveUS6727802B2Avoid collisionShorten transaction timeMemory record carrier reading problemsUnauthorized memory use protectionInformation processingProduct system

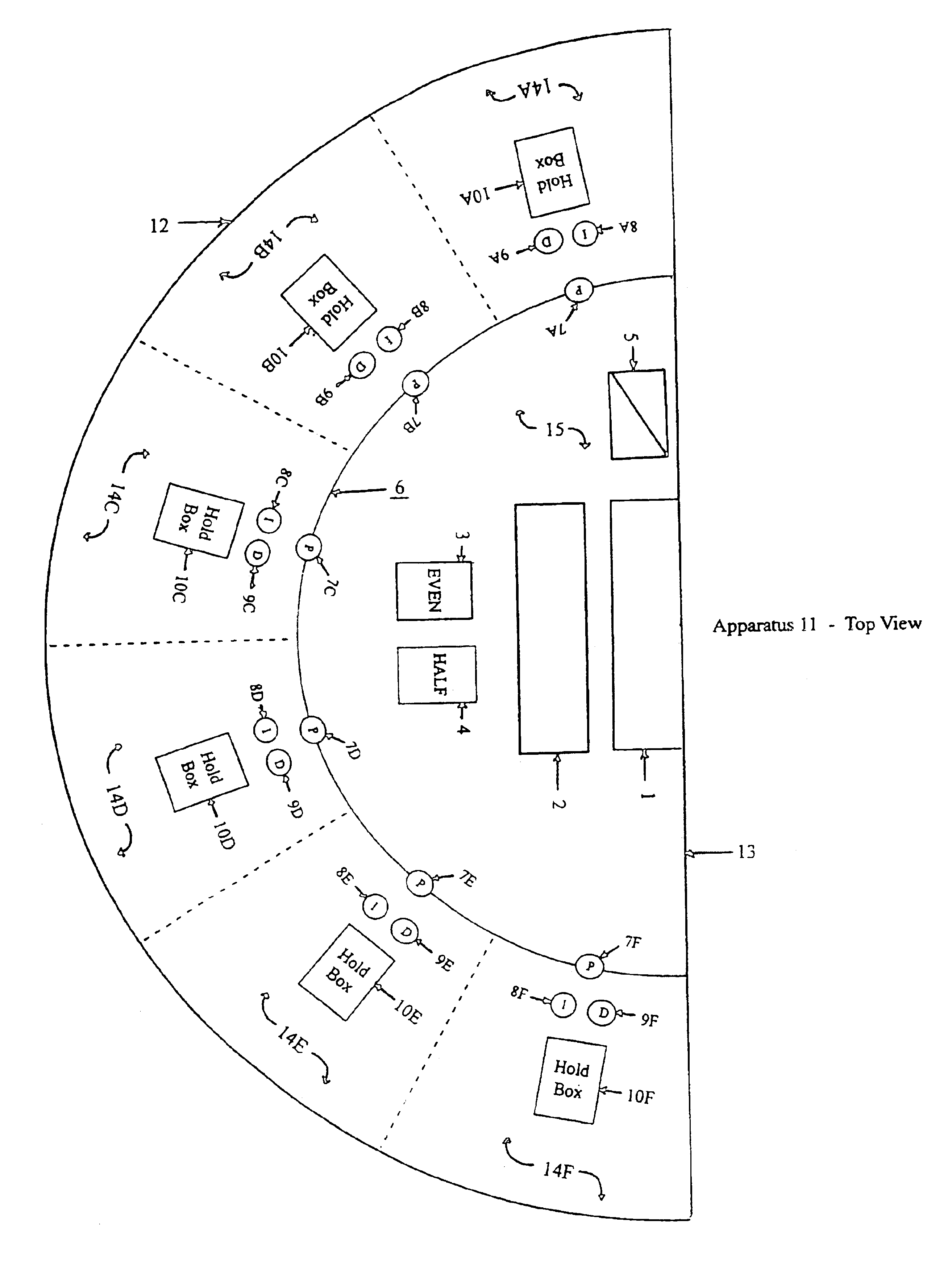

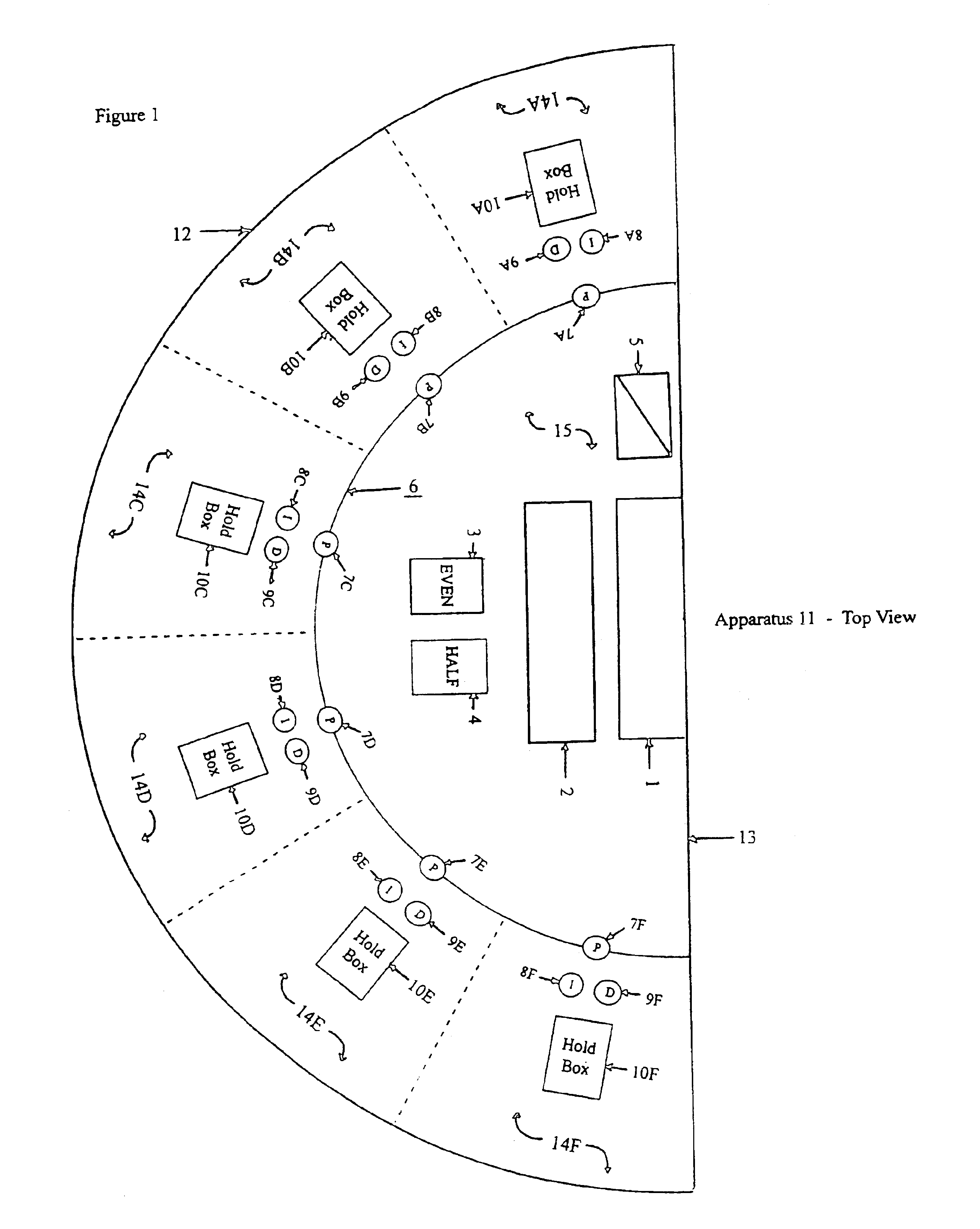

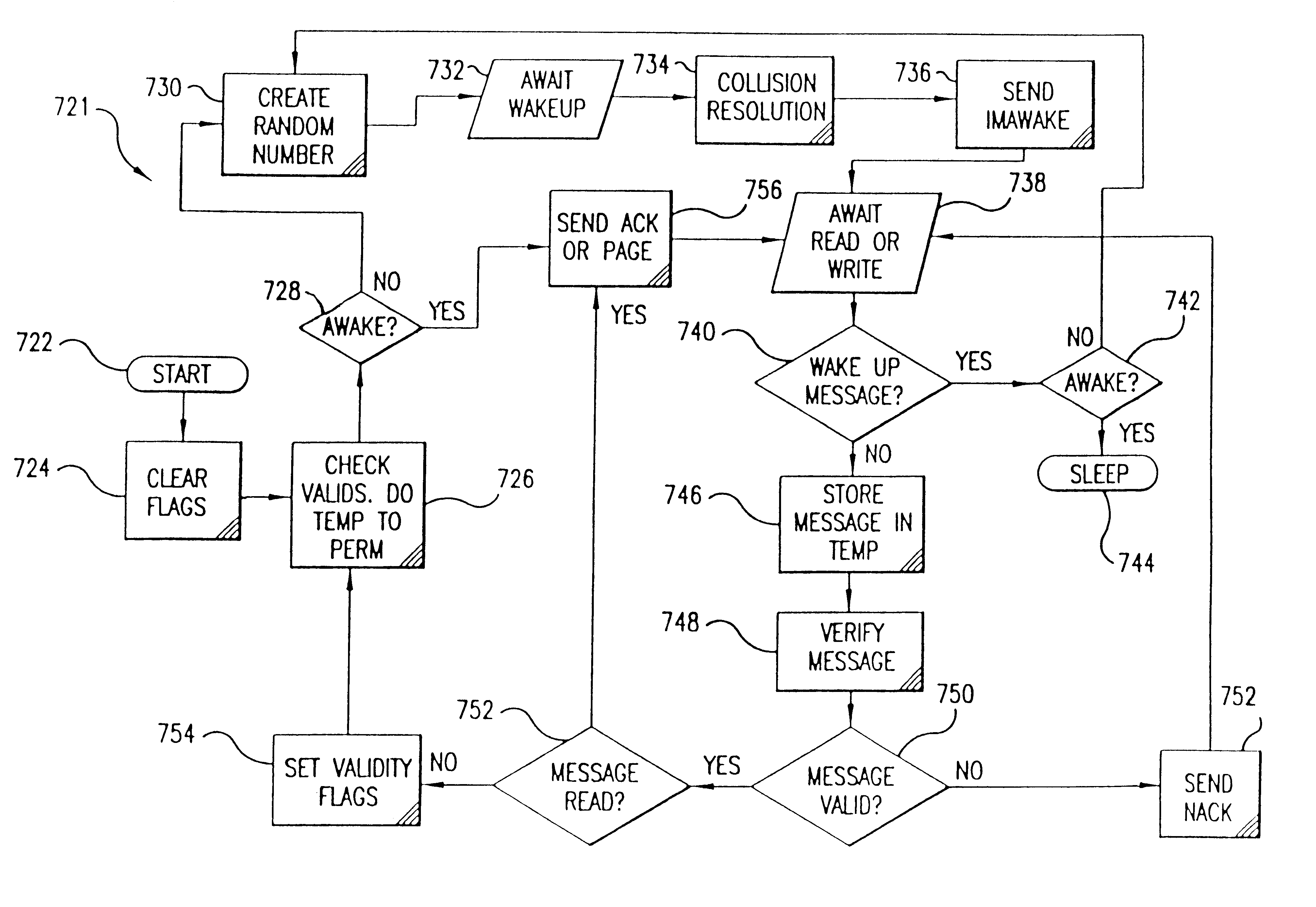

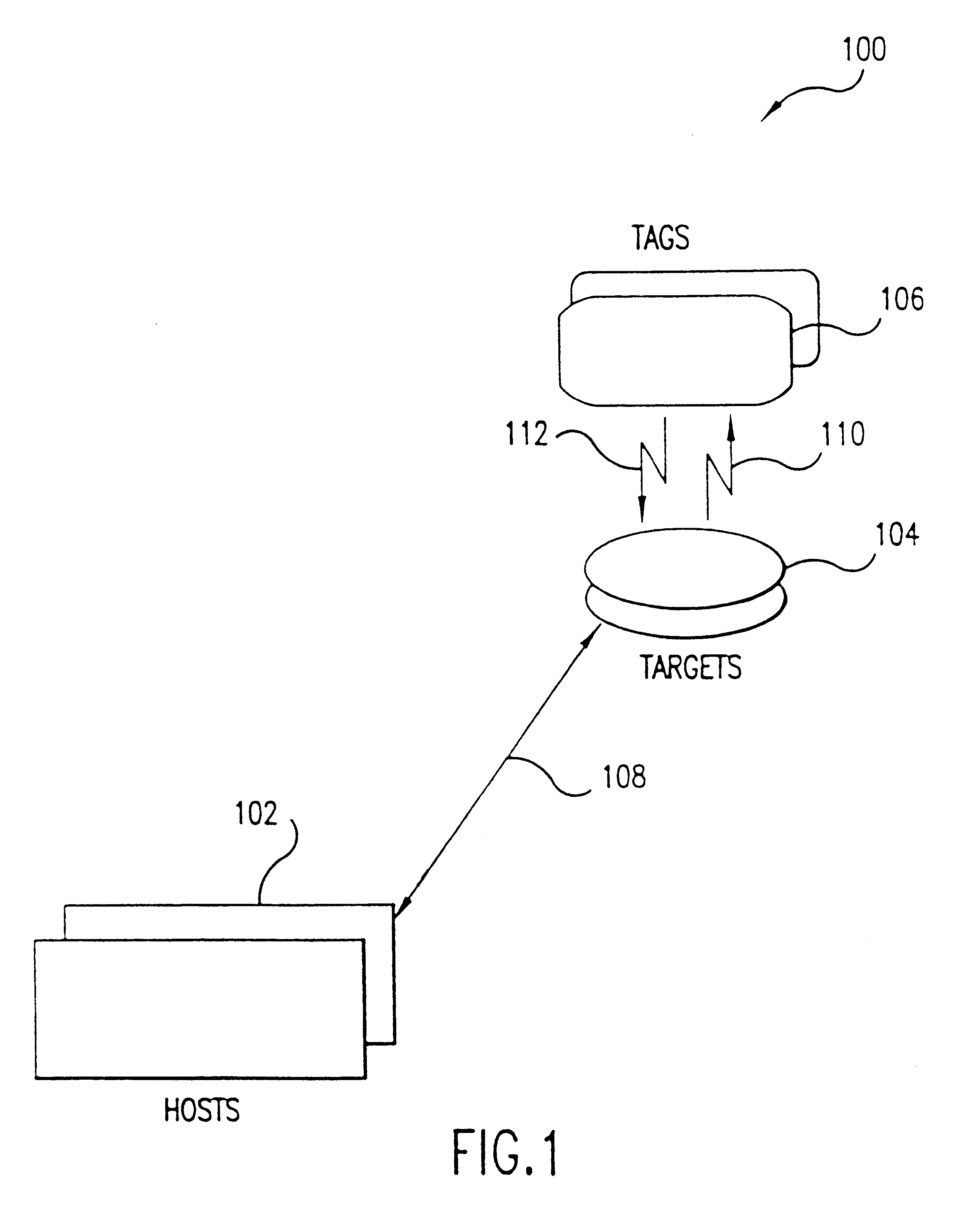

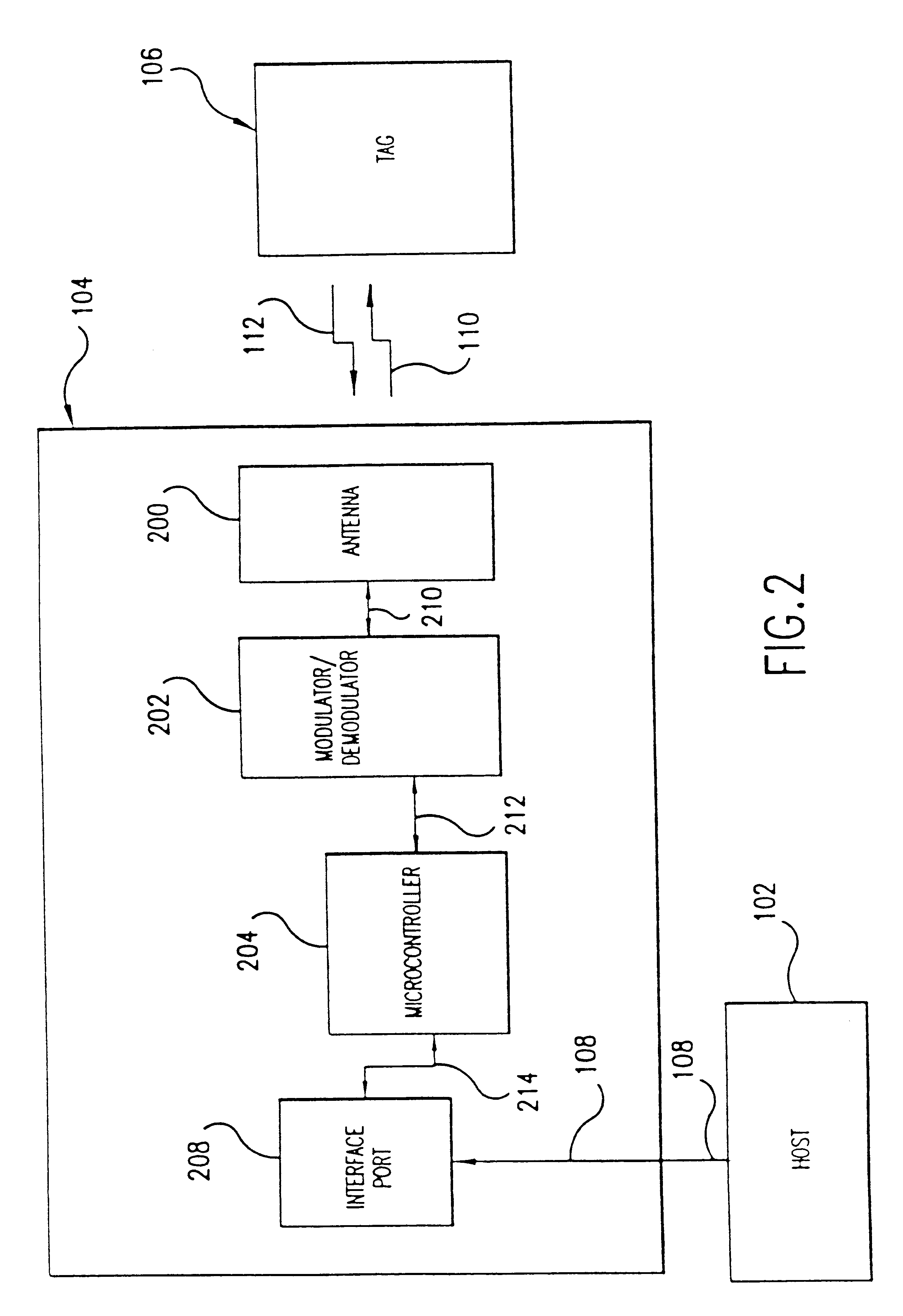

A fast data transfer collection system using message authentication and contactless RF proximity card technology in non-contact storage and retrieval applications. The system is generally comprised of Host computers (application computer systems), Target radio frequency (RF) terminals, and a plurality of portable Tags ("smart" or "proximity" cards). A Host provides specific application functionality to a Tag holder, with a high degree of protection from fraudulent use. A Target provides control of the RF antenna and resolves collisions between multiple Tags in the RF field. A Tag provides reliable, high speed, and well authenticated secure exchanges of data / information with the Host resulting from the use of a custom ASIC design incorporating unique analog and digital circuits, nonvolatile memory, and state logic. Each Tag engages in a transaction with the Target in which a sequence of message exchanges allow data to be read(written) from(to) the Tag. These exchanges establish the RF communication link, resolve communication collisions with other Tags, authenticate both parties in the transaction, rapidly and robustly relay information through the link, and ensure the integrity and incorruptibility of the transaction. The system architecture provides capabilities to ensure the integrity of the data transferred thus eliminating the major problem of corrupting data on the card and in the system. The architecture and protocol are designed to allow simple and efficient integration of the transaction product system into data / information processing installations.

Owner:KELLY GUY M +3

Method and system for performing money transfer transactions

InactiveUS20030083987A1Shorten transaction timeImprove accuracyComplete banking machinesFinanceDatabaseElectronic transaction

Owner:THE WESTERN UNION CO

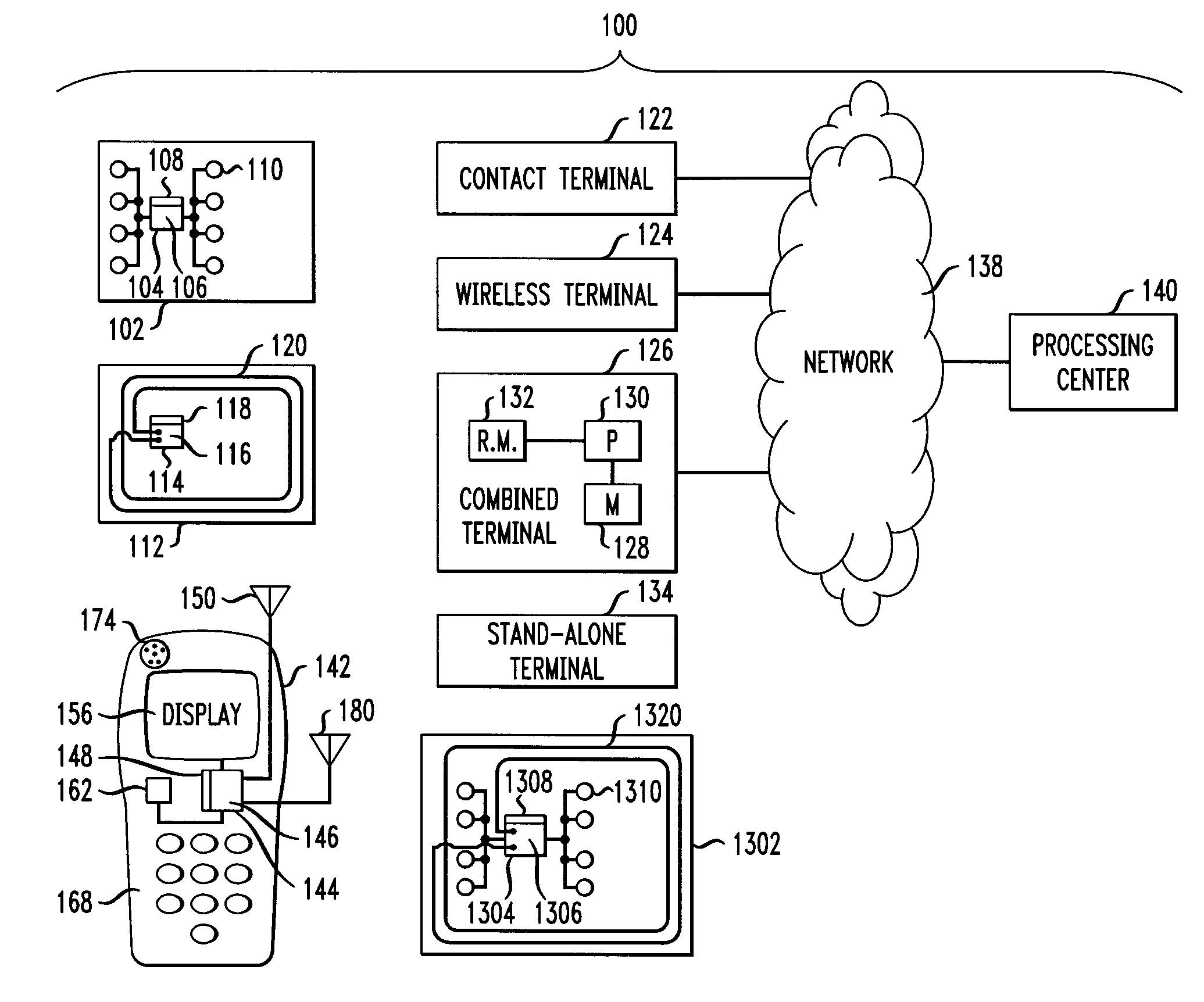

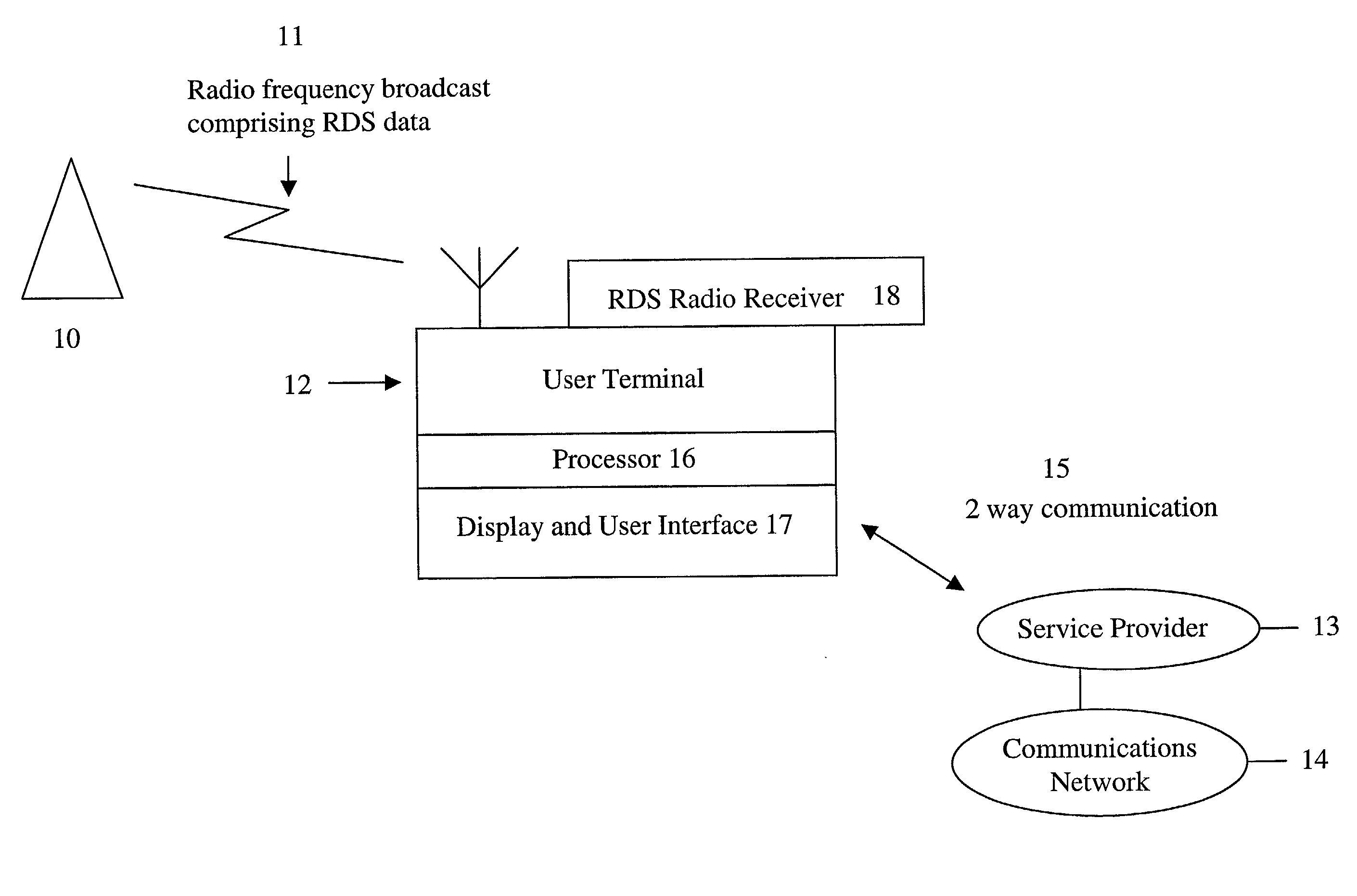

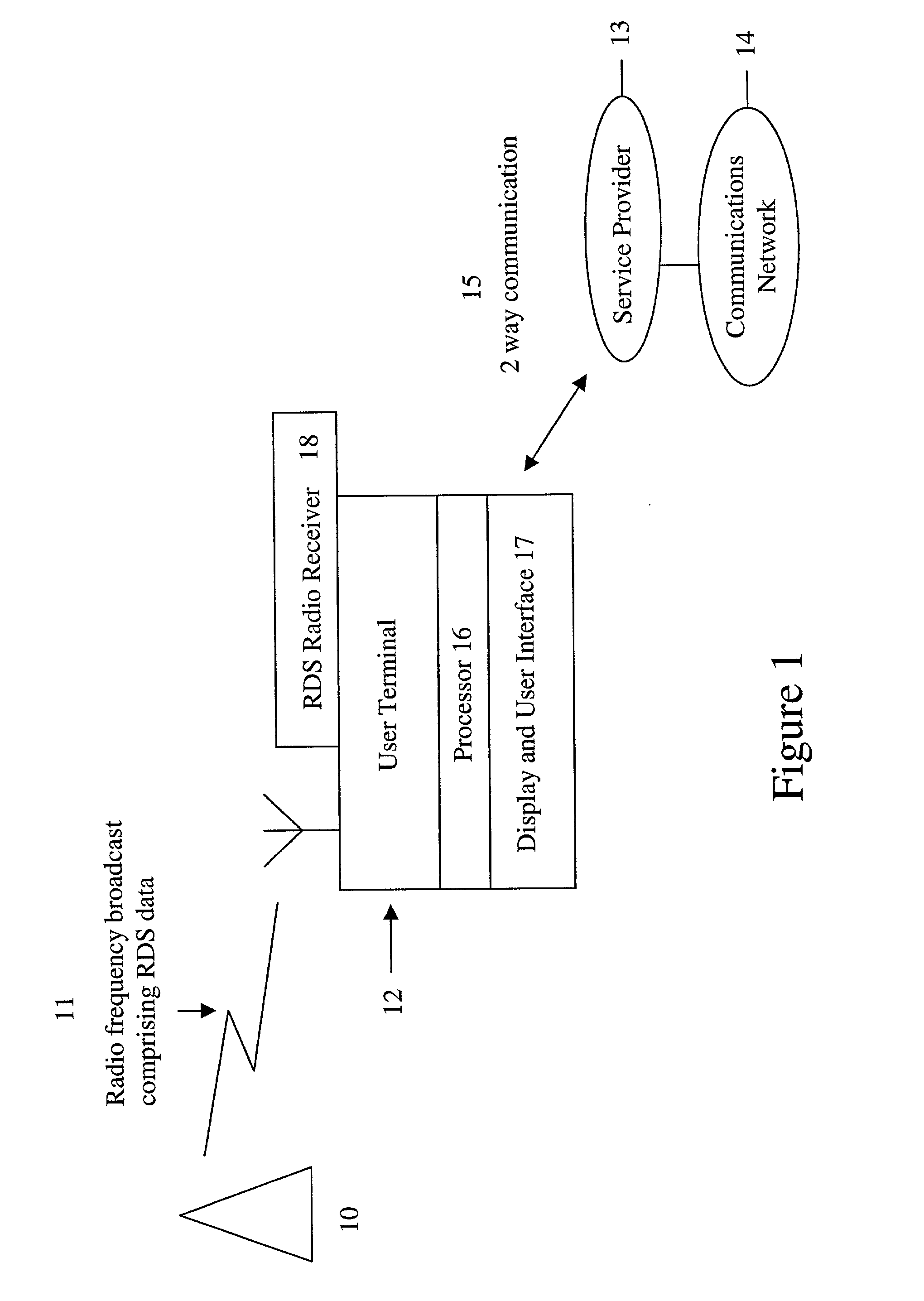

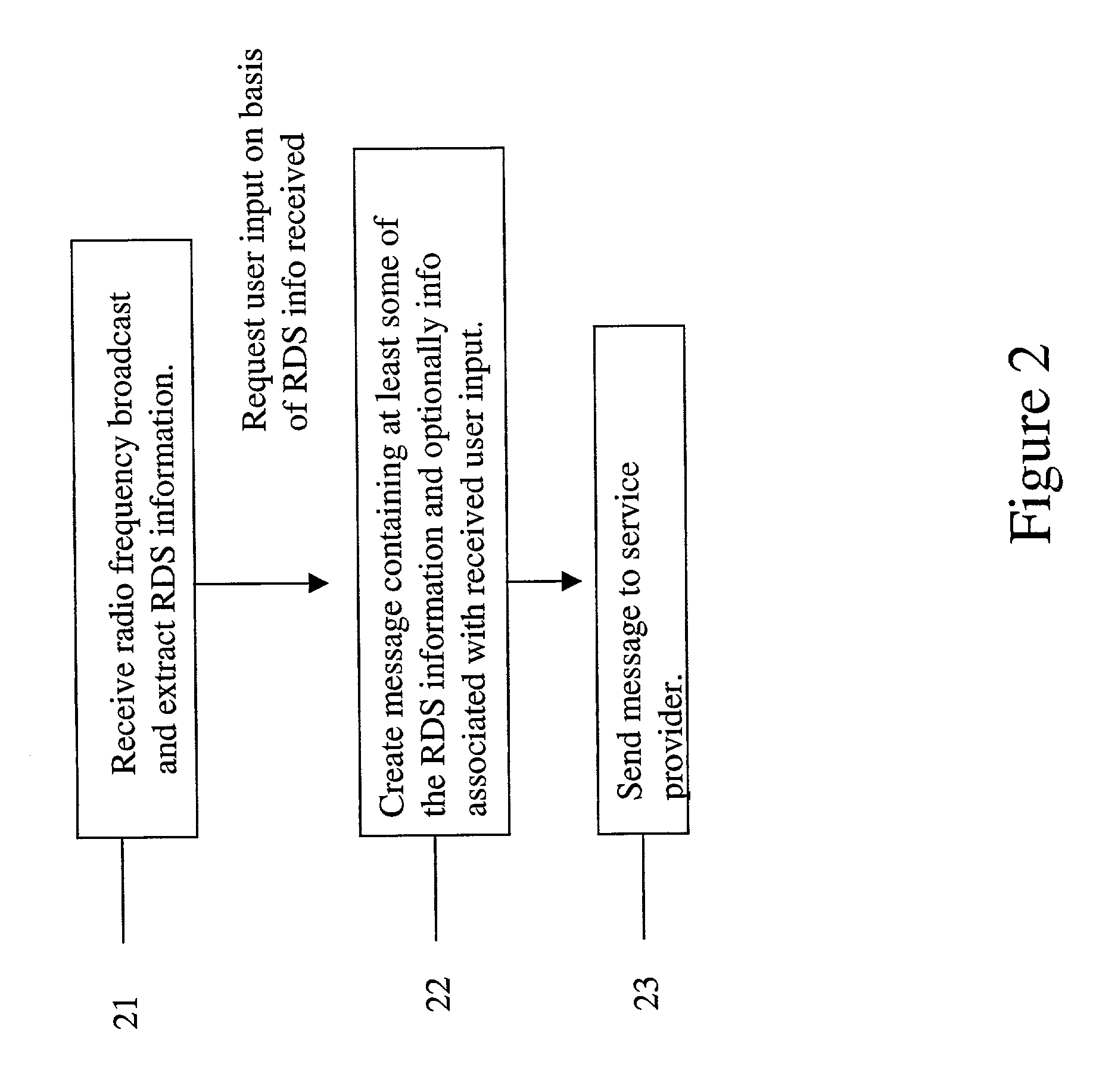

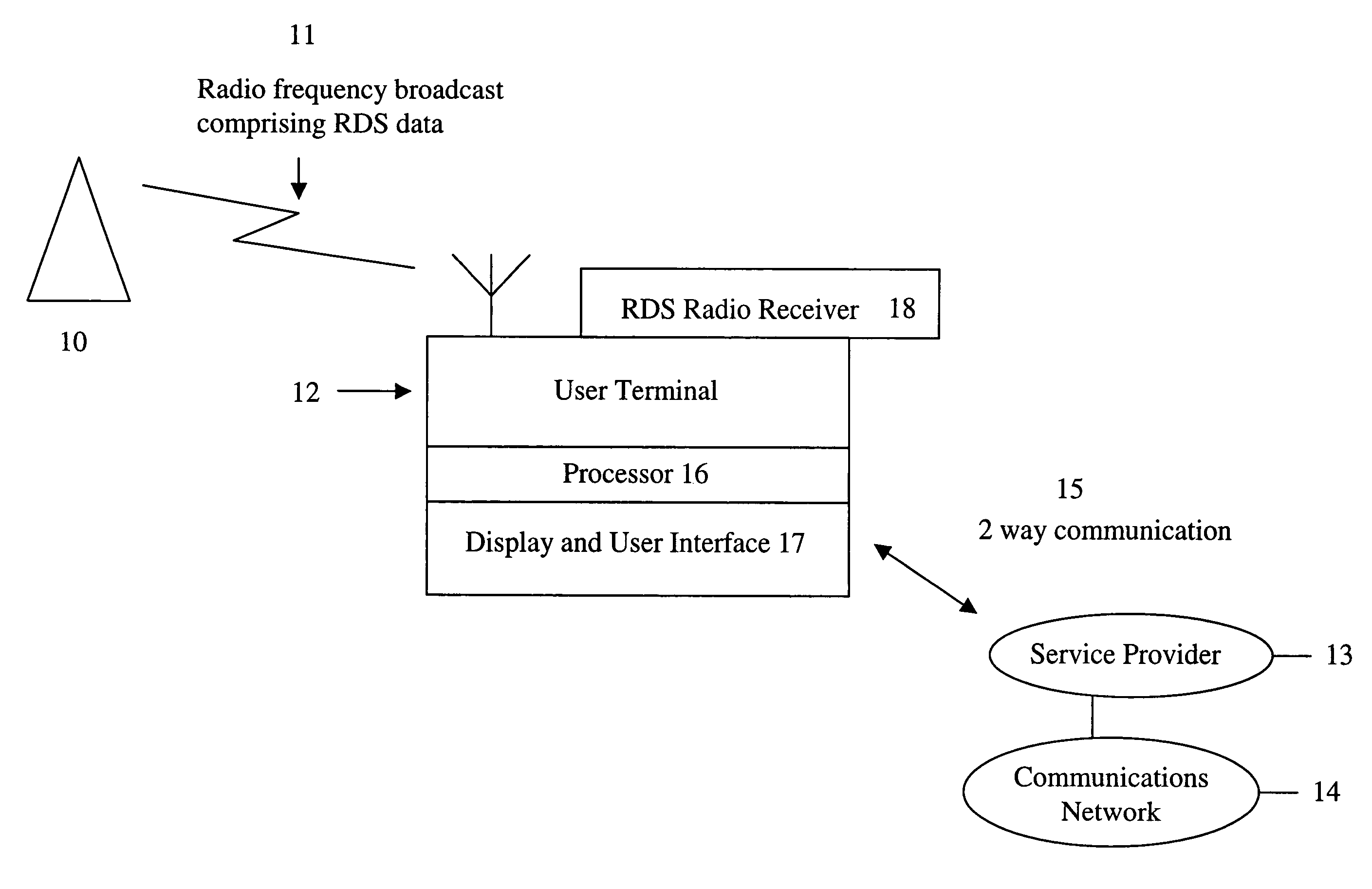

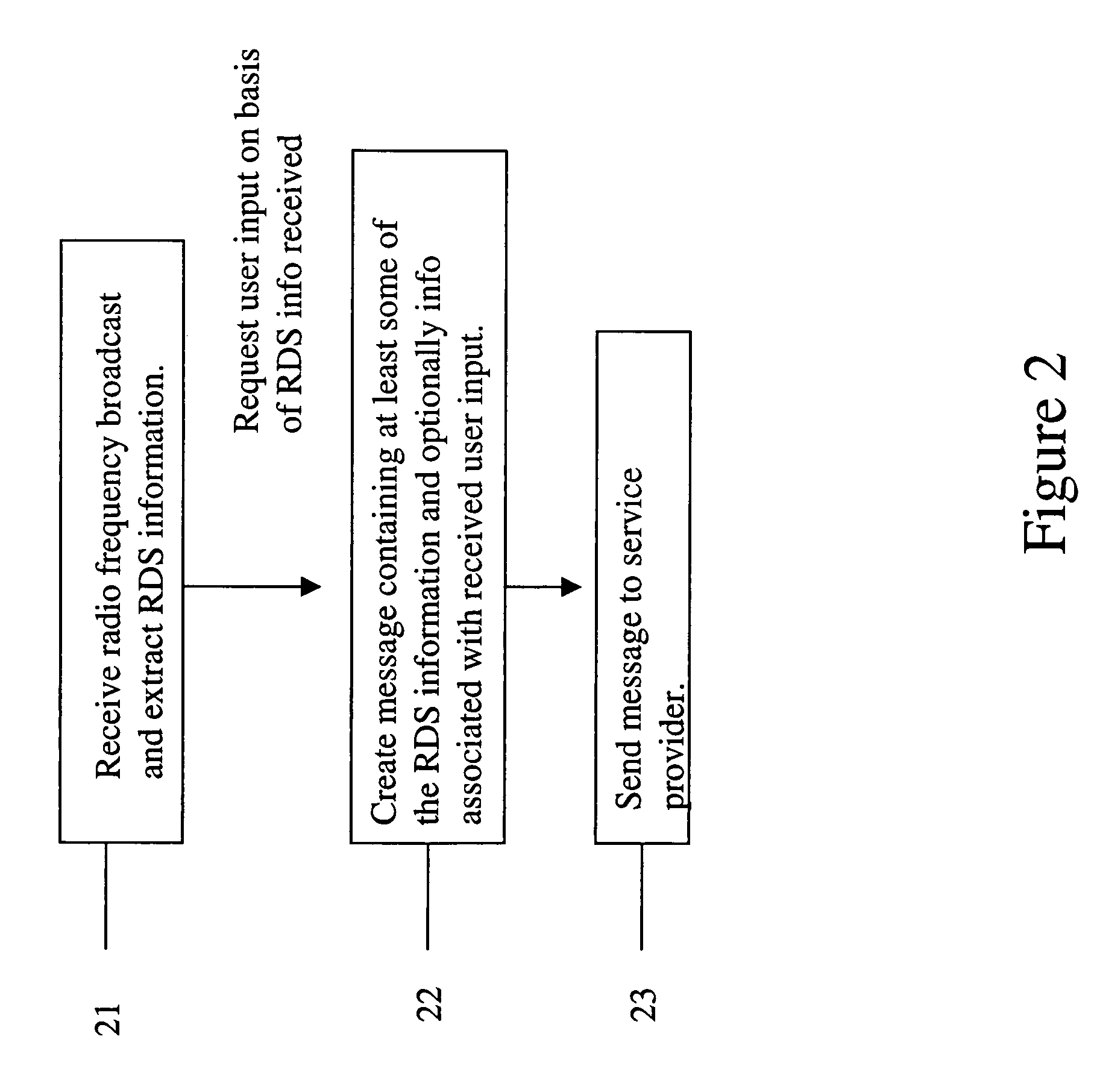

Use of radio data service (RDS) information to automatically access a service provider

ActiveUS20040203406A1Simpler to purchaseIncrease incomeRadio data system/radio broadcast data systemAssess restrictionRadio receptionShort Message Service

Wireless terminals such as mobile phones which provide cellular communications for example for telephony and short message service (SMS) are well known and more recently such terminals are also able to provide FM radio reception. RDS information received at such a terminal is used to access a service provider via any suitable medium e.g. email, fax, telephone, SMS message, etc. This enables the end user to access the service provider quickly and effectively for example, to purchase a copy of a record heard on the radio or to request information about a product advertised on the radio. Also, the service provider is able to deal with the user interaction effectively because the RDS information can be used to assess the user's requirements for the transaction in advance. In a preferred example, the service provider comprises a contact center such as a call center and the RDS information is used to allocate an appropriate call center agent.

Owner:ZHIGU HLDG

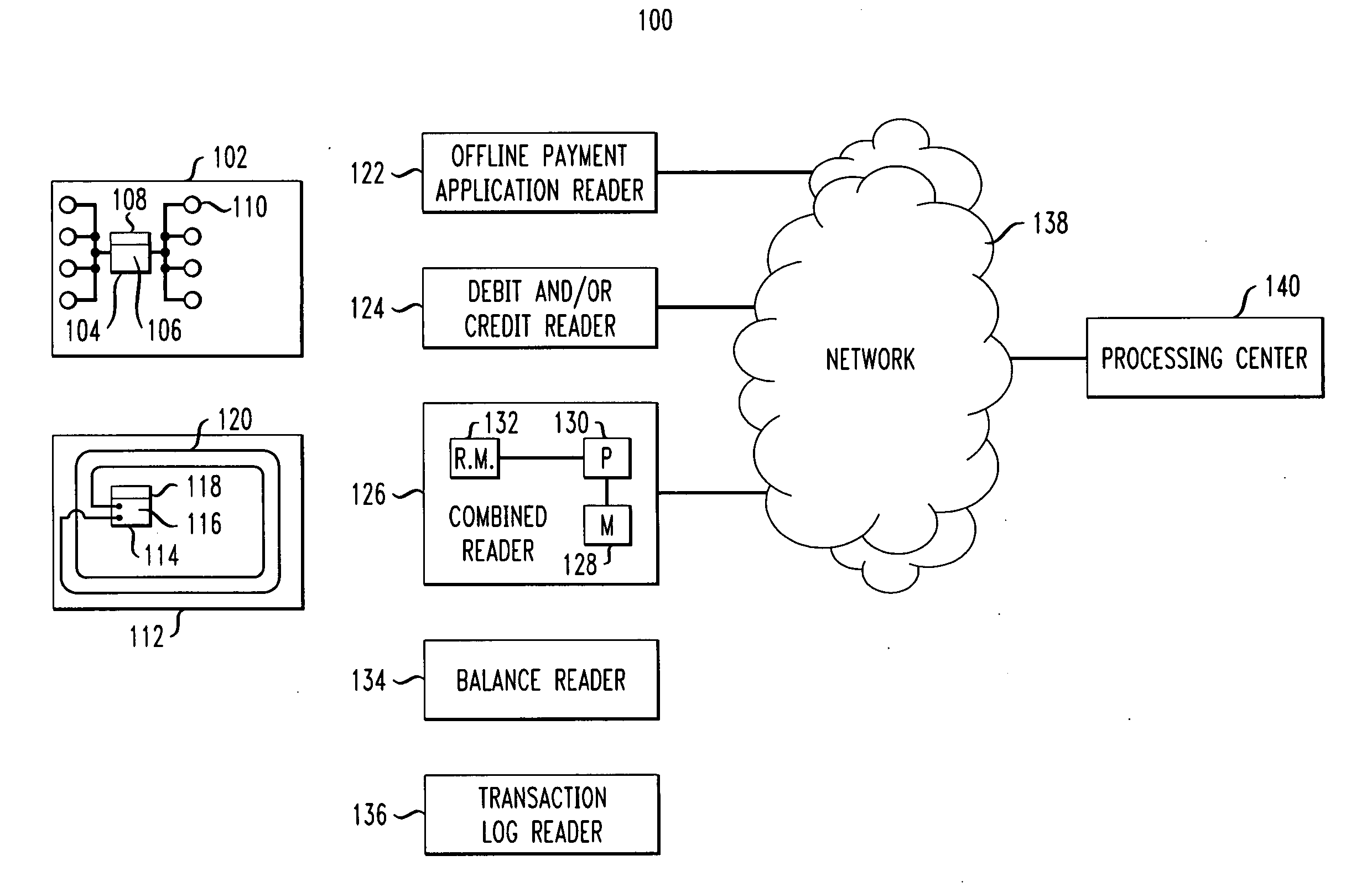

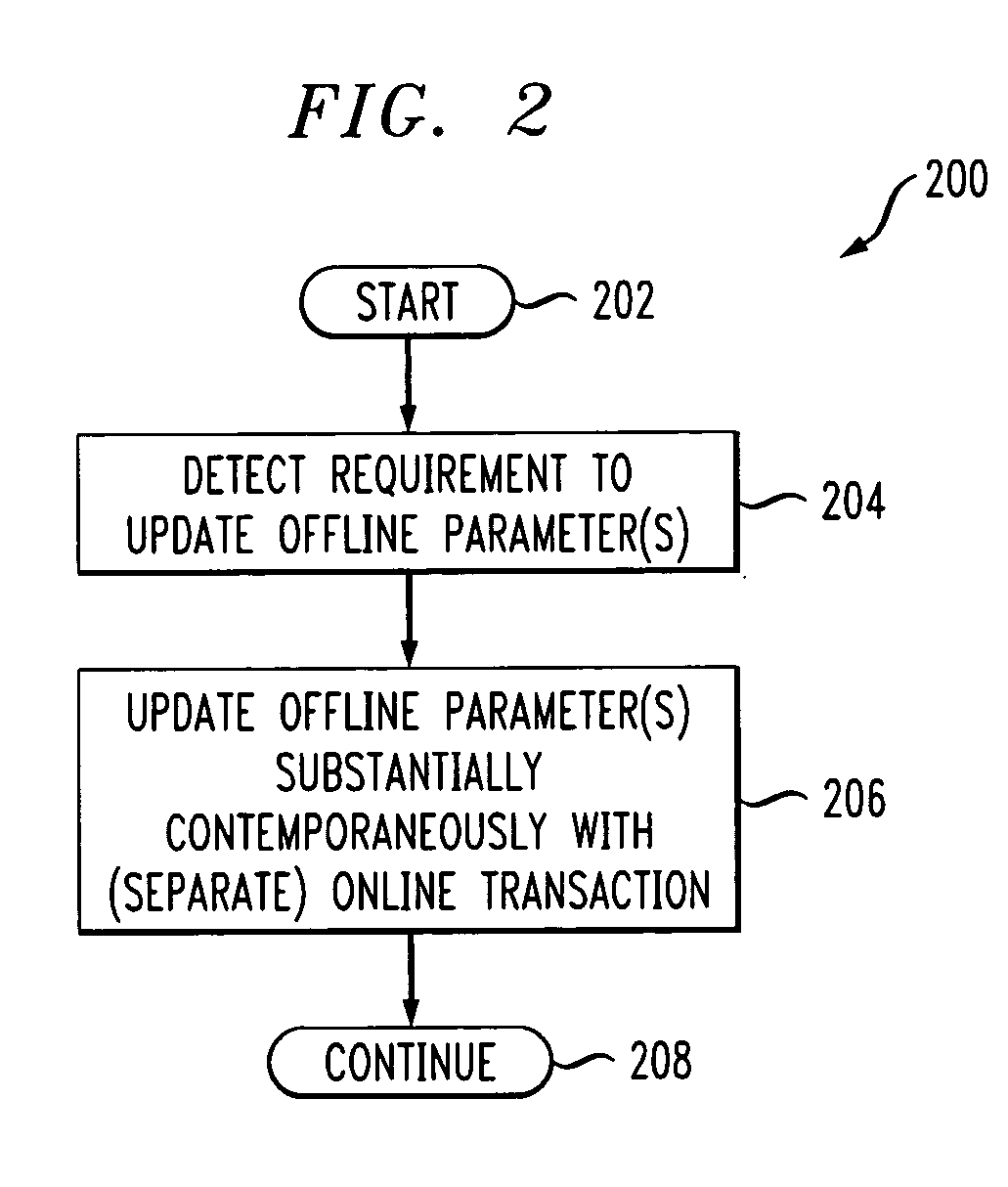

Payment apparatus and method

InactiveUS20070168260A1Shorten transaction timeEliminate needAcutation objectsPayment architectureVisibilityOnline trading

Techniques are provided for updating an offline parameter of a payment device having an online-capable application and a primarily offline application. The offline parameter can be a counter reflective of an offline spending balance. The same parameter can be shared between the applications, or cross-application visibility of the parameter can be provided. When a requirement to update the offline parameter is determined, the offline parameter can be updated substantially contemporaneously with an online transaction. The updates can be transparent to the user, allowing substantial duplication of the debit card and / or credit card experience with an offline payment device.

Owner:MASTERCARD INT INC

Use of radio data service (RDS) information to automatically access a service provider

InactiveUS7340249B2Quickly and easily and effectively purchaseIncrease volumeBroadcast transmission systemsBroadcast services for monitoring/identification/recognitionRadio receptionShort Message Service

Wireless terminals such as mobile phones which provide cellular communications for example for telephony and short message service (SMS) are well known and more recently such terminals are also able to provide FM radio reception. RDS information received at such a terminal is used to access a service provider via any suitable medium e.g. email, fax, telephone, SMS message, etc. This enables the end user to access the service provider quickly and effectively for example, to purchase a copy of a record heard on the radio or to request information about a product advertised on the radio. Also, the service provider is able to deal with the user interaction effectively because the RDS information can be used to assess the user's requirements for the transaction in advance. In a preferred example, the service provider comprises a contact center such as a call center and the RDS information is used to allocate an appropriate call center agent.

Owner:ZHIGU HLDG

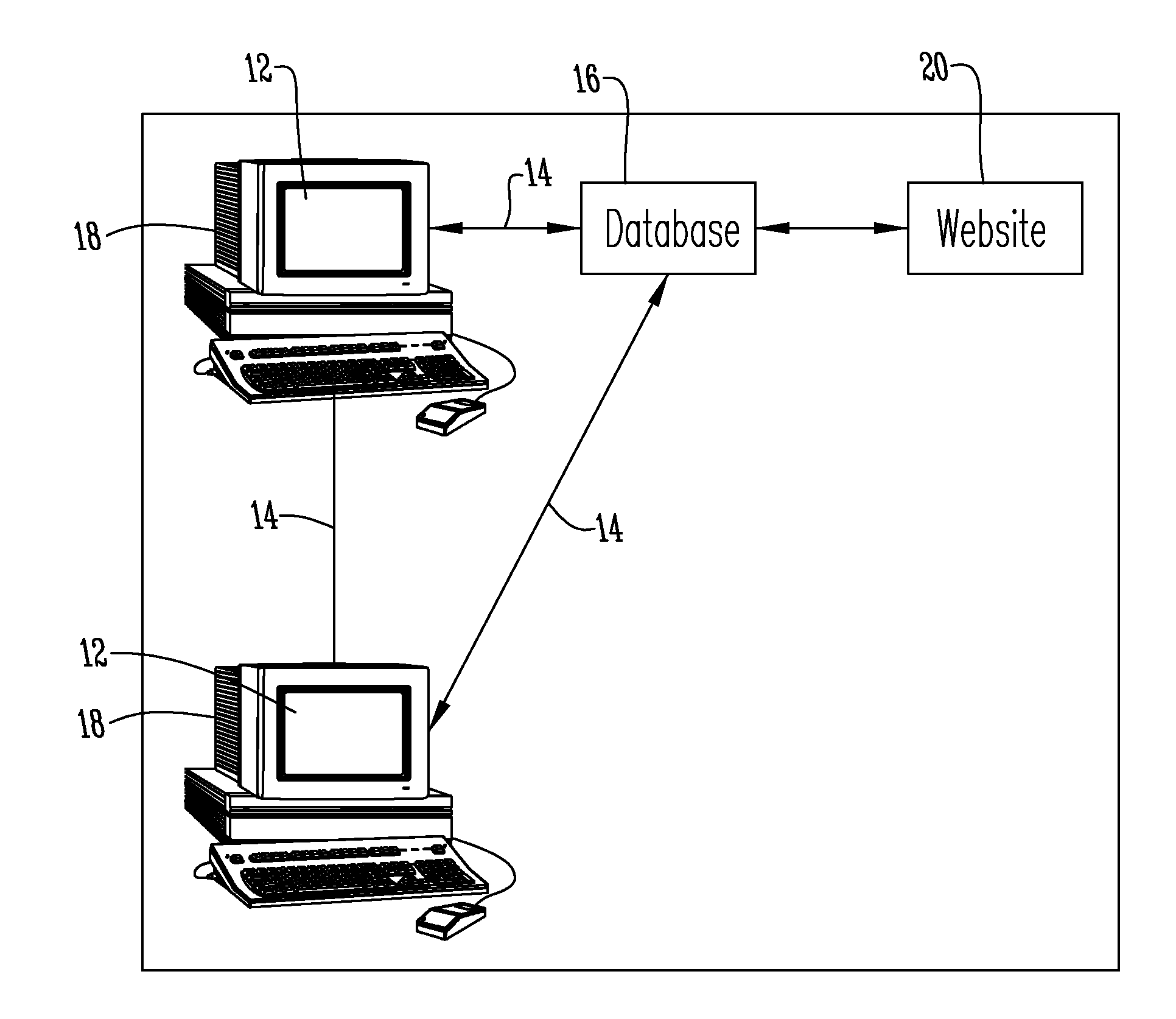

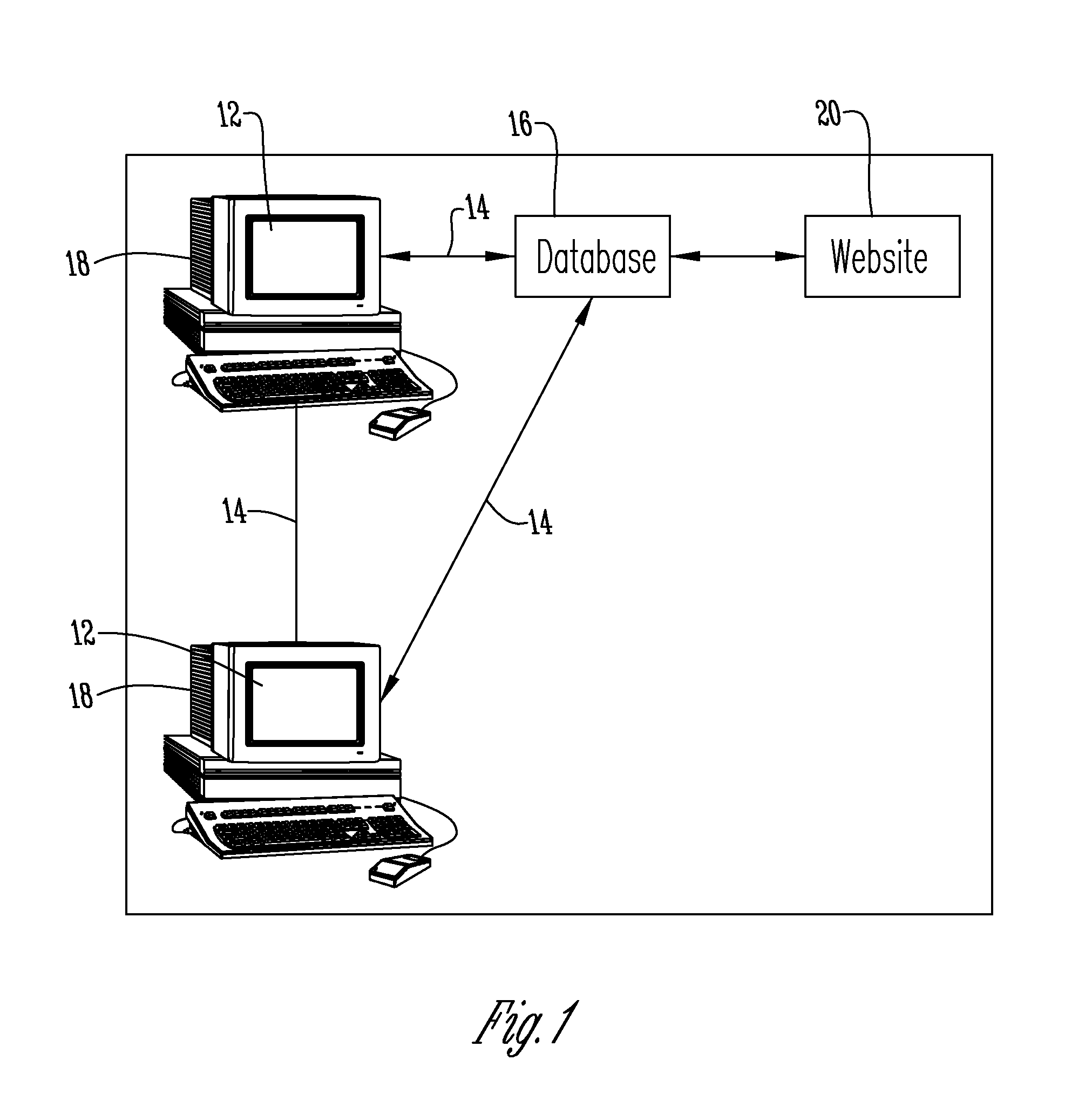

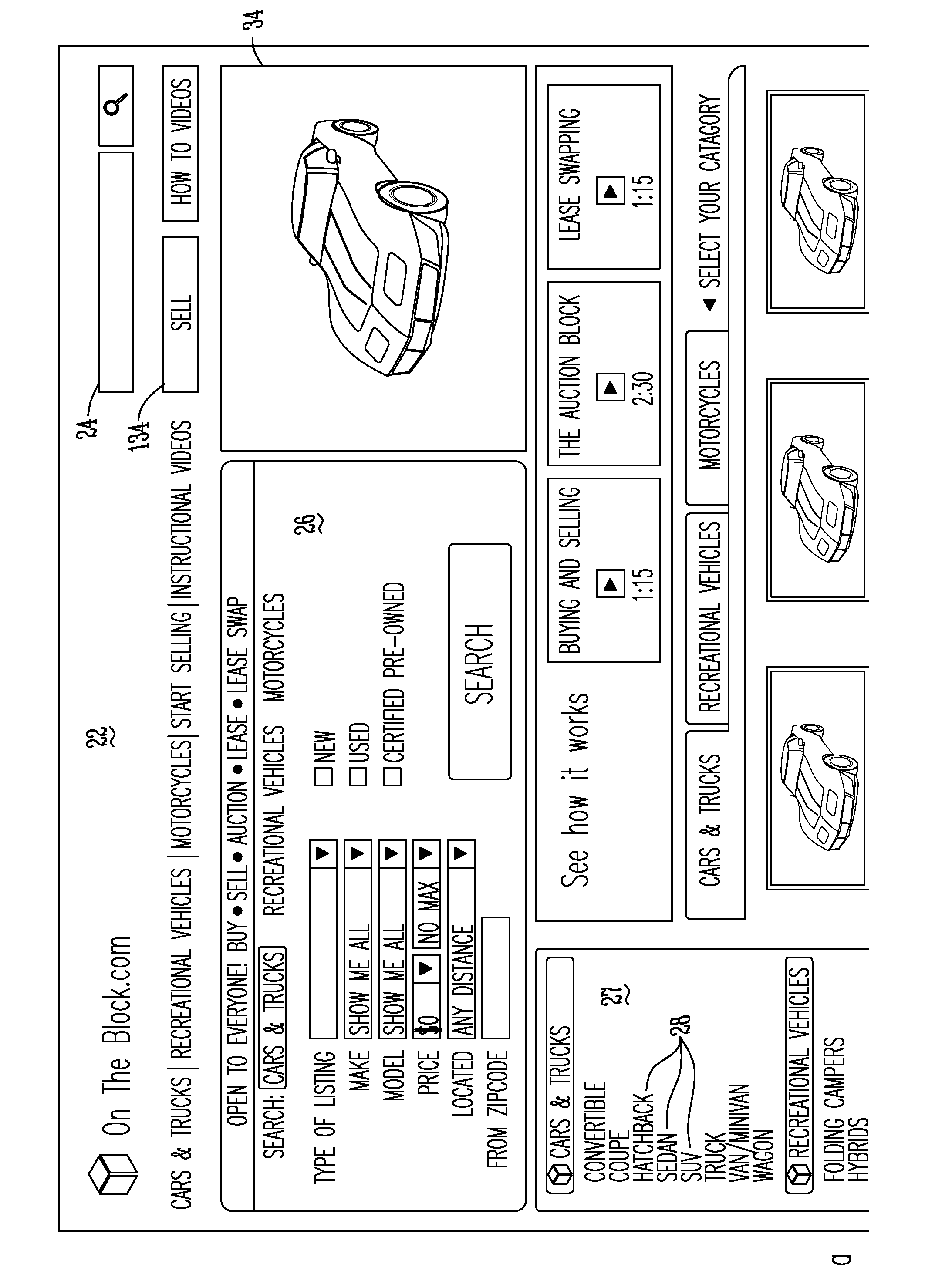

System and method of accessing an online auction of a vehicle through an auction website and a dealer website

ActiveUS20150254762A1Convenient transactionShorten transaction timeAdvertisementsGeographical information databasesInternet trafficCollaboration

A system for auctioning a vehicle through the internet and through the collaboration of a vehicle dealer and an auction house. The system includes a vehicle dealer having their own website, and an auction house having their own website. Through collaboration between the vehicle dealer and the auction house various other cobranded websites are presented for the auction of vehicles. These cobranded websites are accessible either through the vehicle dealer website or the auction house website, and are either hosted on the vehicle dealer website or the auction house website. In this way, greater access is provided to the vehicle auction while maintaining the continuity of experience for the buyer, thereby increasing sales and internet traffic.

Owner:ON THE BLOCK LLC

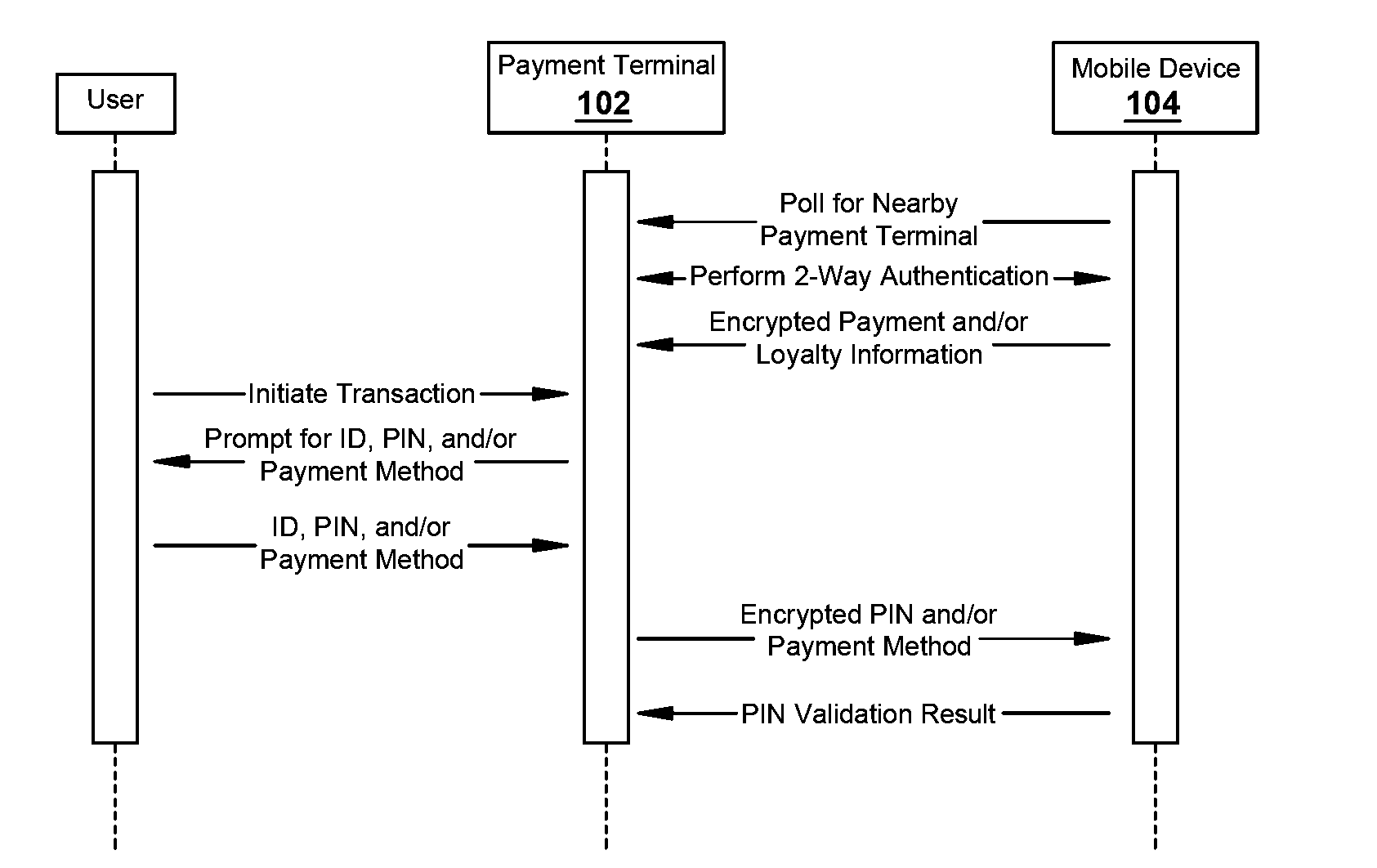

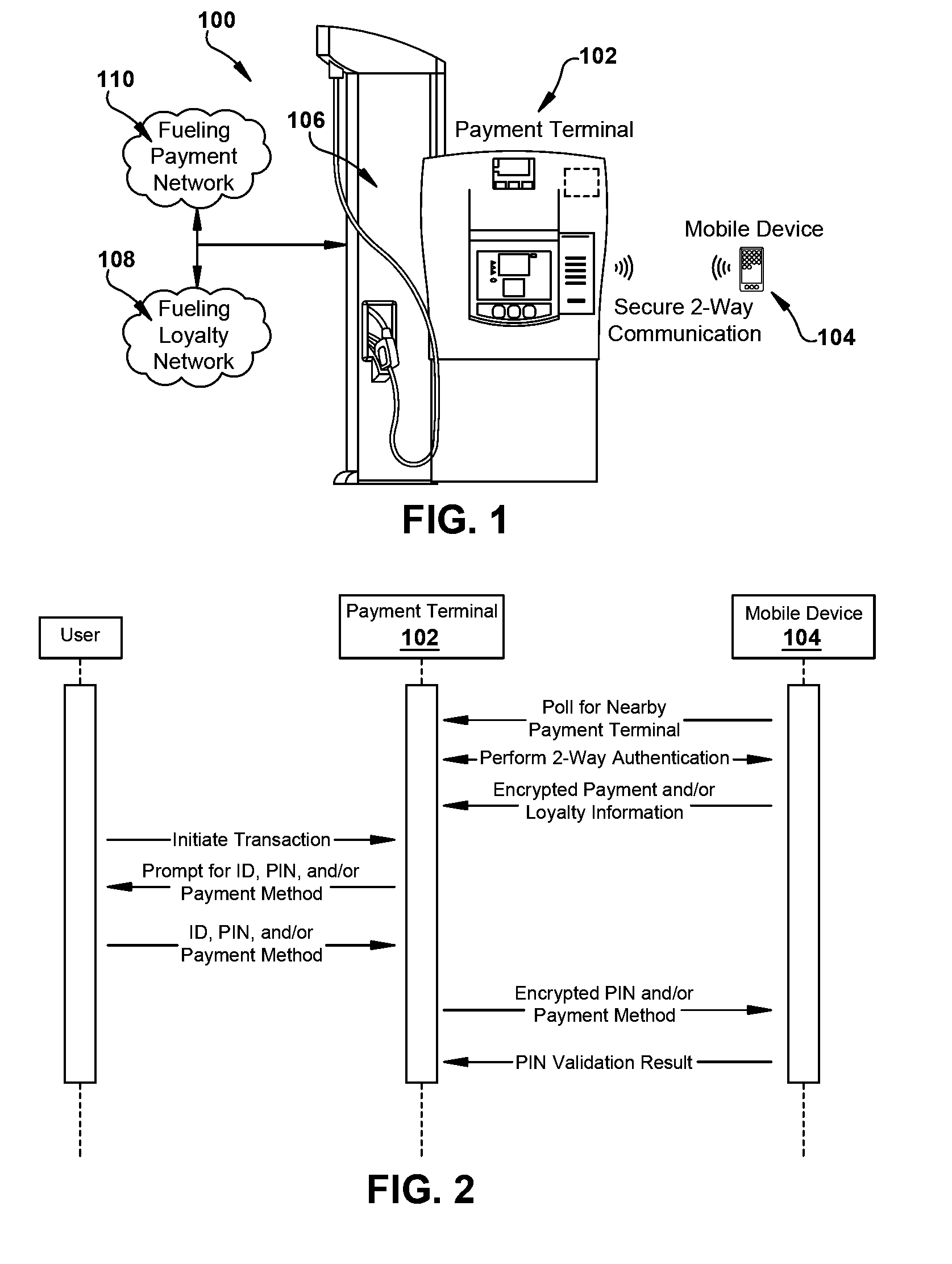

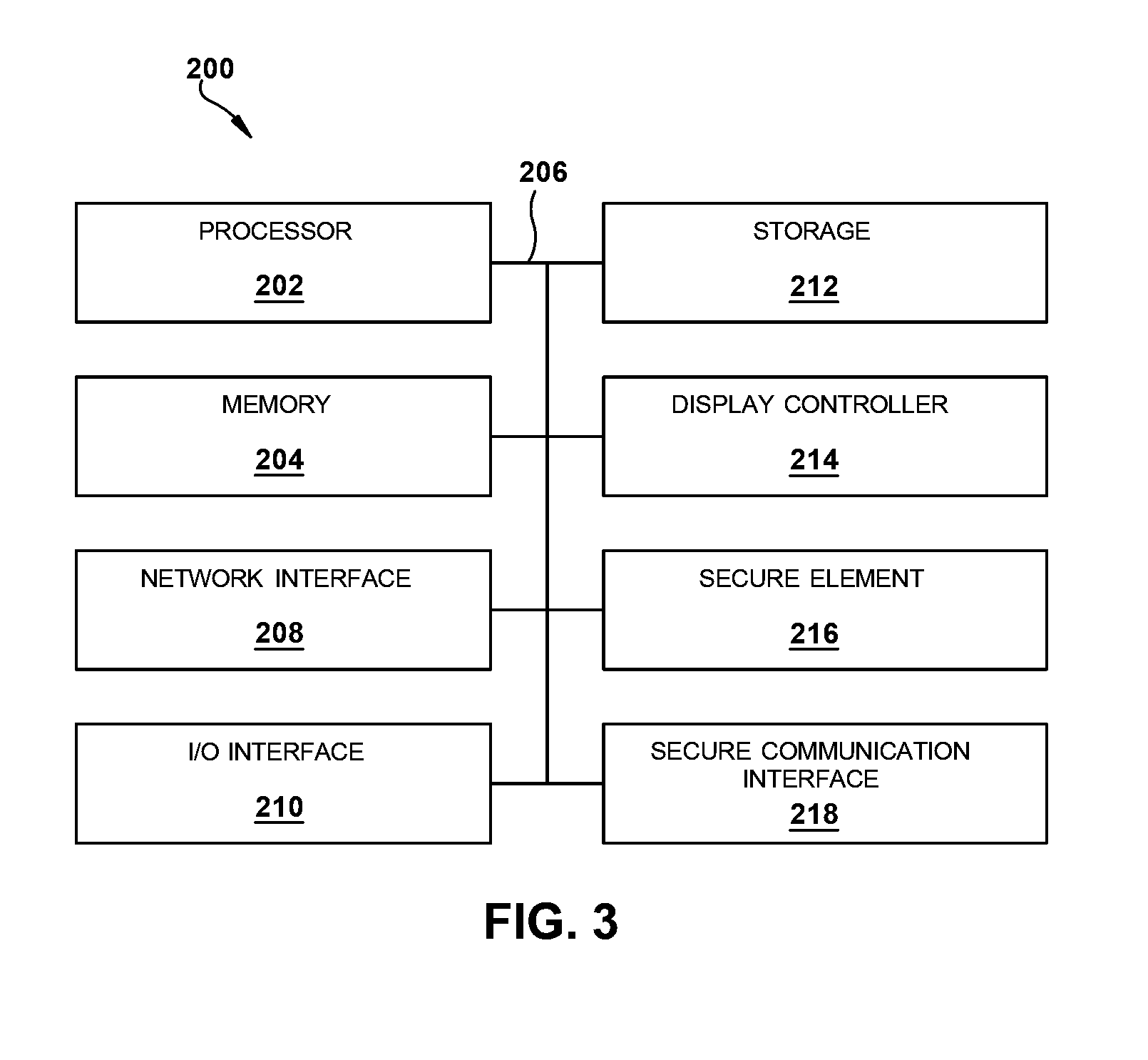

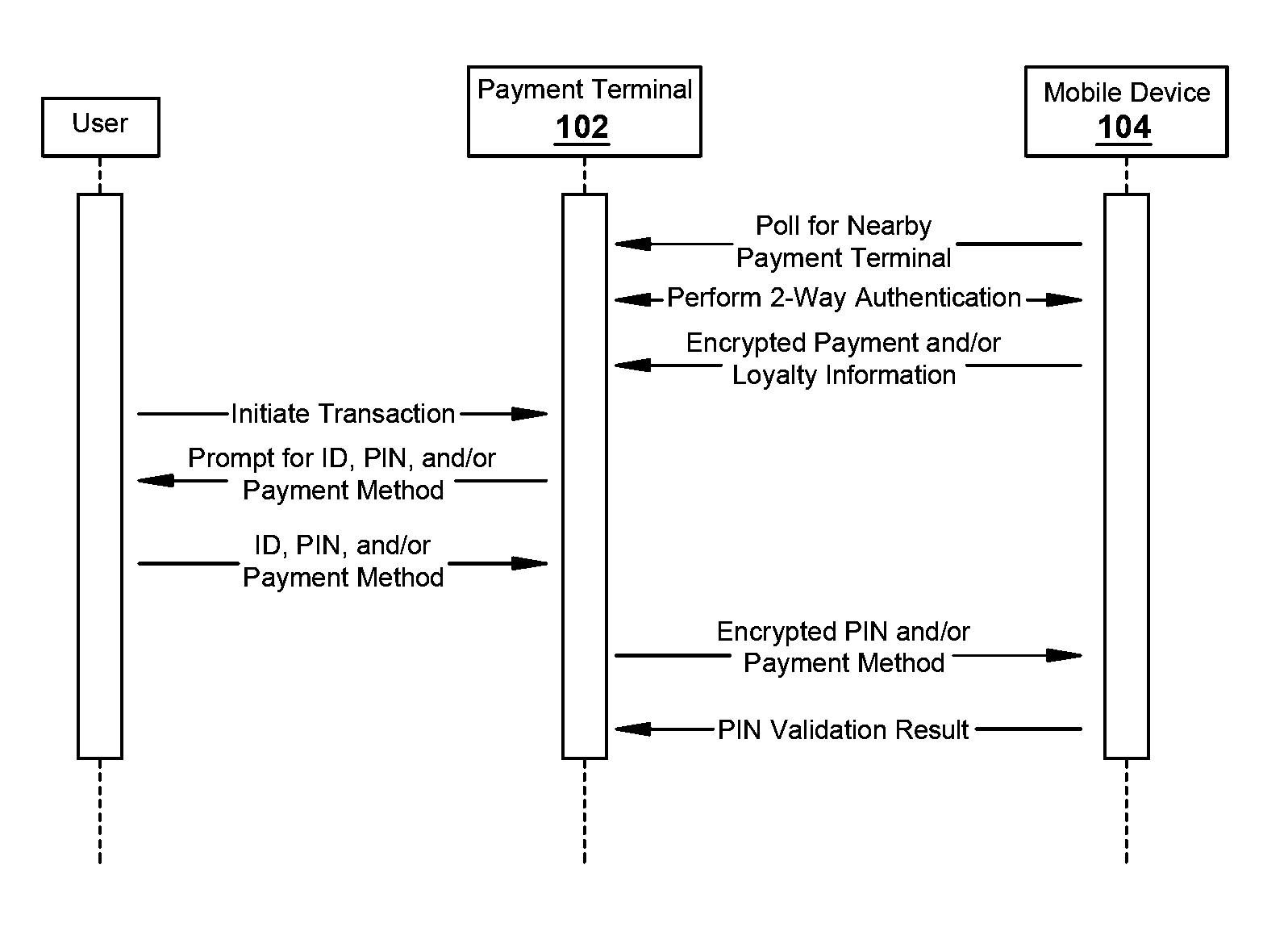

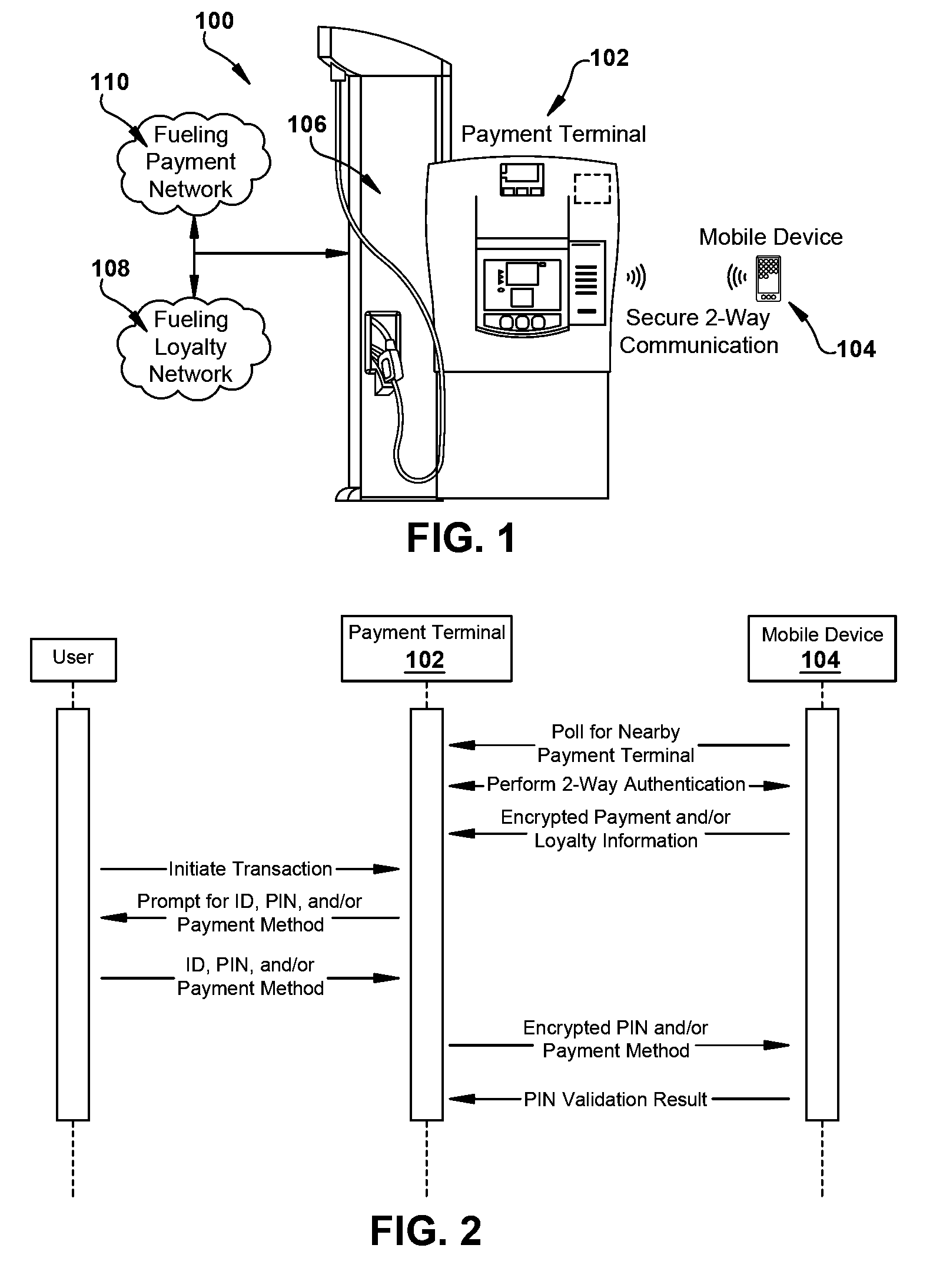

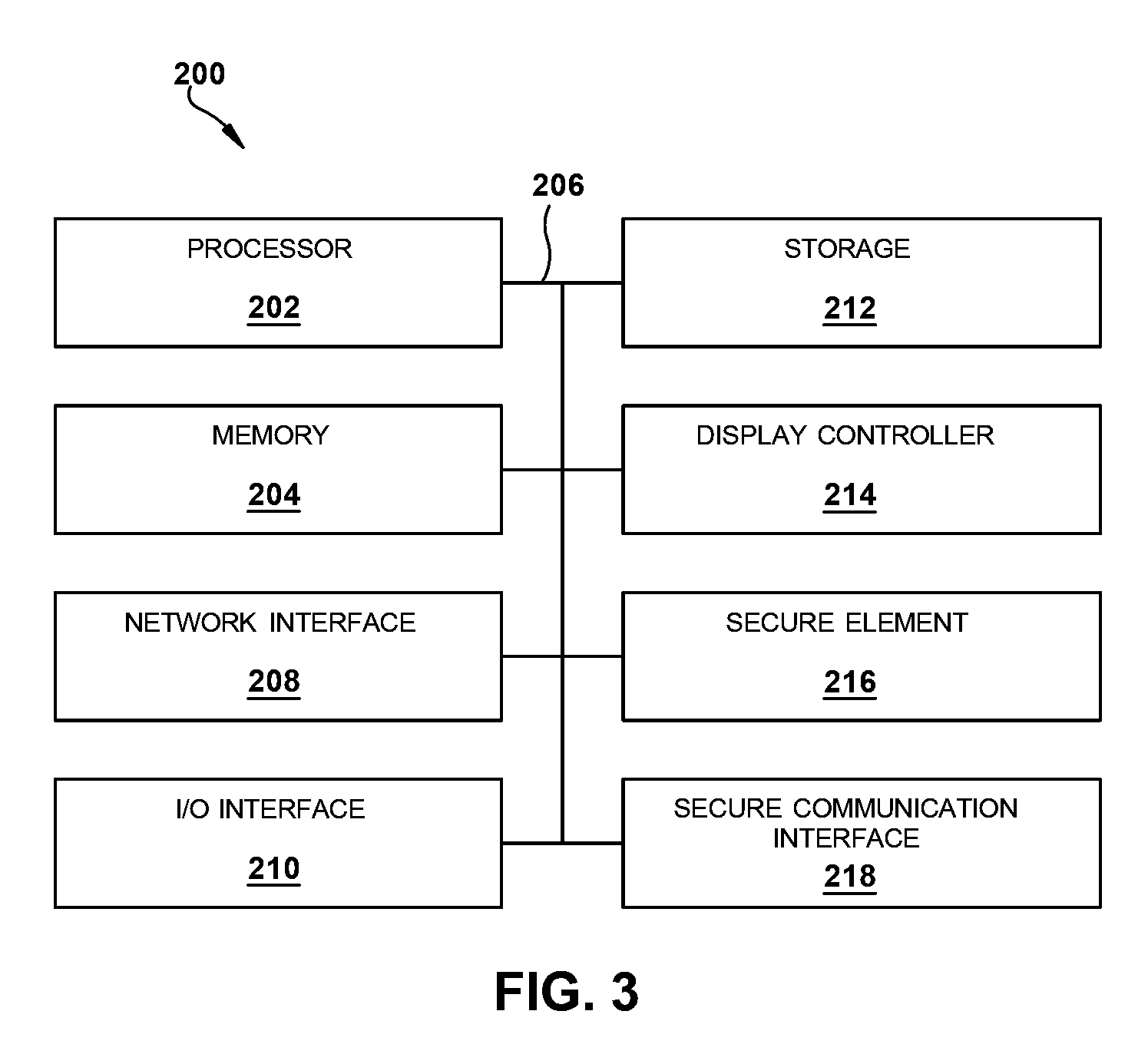

Systems and methods for convenient and secure mobile transactions

ActiveUS20150143116A1Easy to completeShorten transaction timeCryptography processingUser identity/authority verificationComputer terminalMobile transaction

Systems and methods for conducting convenient and secure mobile transactions between a payment terminal and a mobile device, e.g., in a fueling environment, are disclosed herein. In some embodiments, the payment terminal and the mobile device conduct a mutual authentication process that, if successful, produces a session key which can be used to encrypt sensitive data to be exchanged between the payment terminal and the mobile device. Payment and loyalty information can be securely communicated from the mobile device to the payment terminal using the session key. This can be done automatically, without waiting for the user to initiate a transaction, to shorten the overall transaction time. The transaction can also be completed without any user interaction with the mobile device, increasing the user's convenience since the mobile device can be left in the user's pocket, purse, vehicle, etc.

Owner:WAYNE FUELING SYST

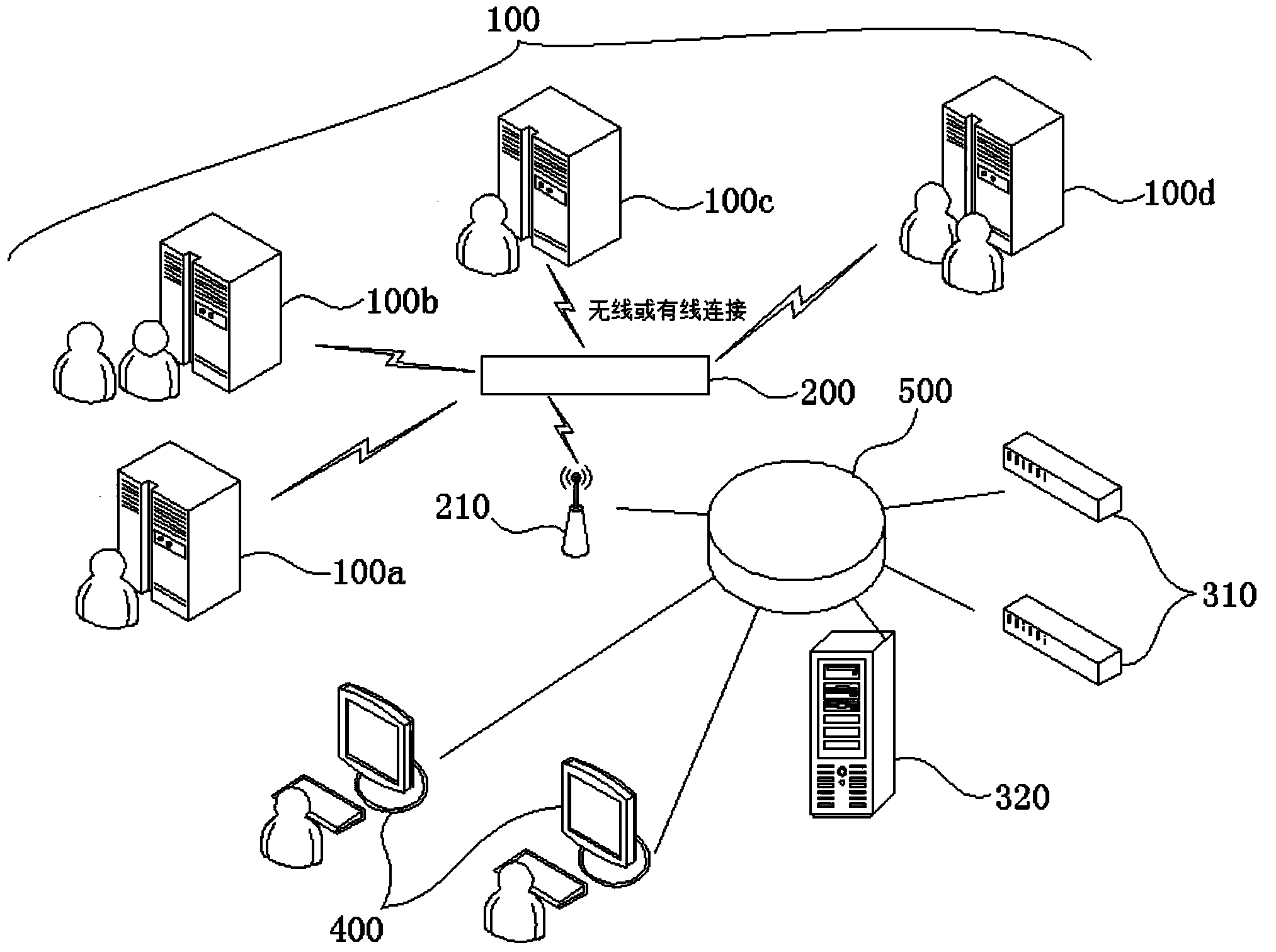

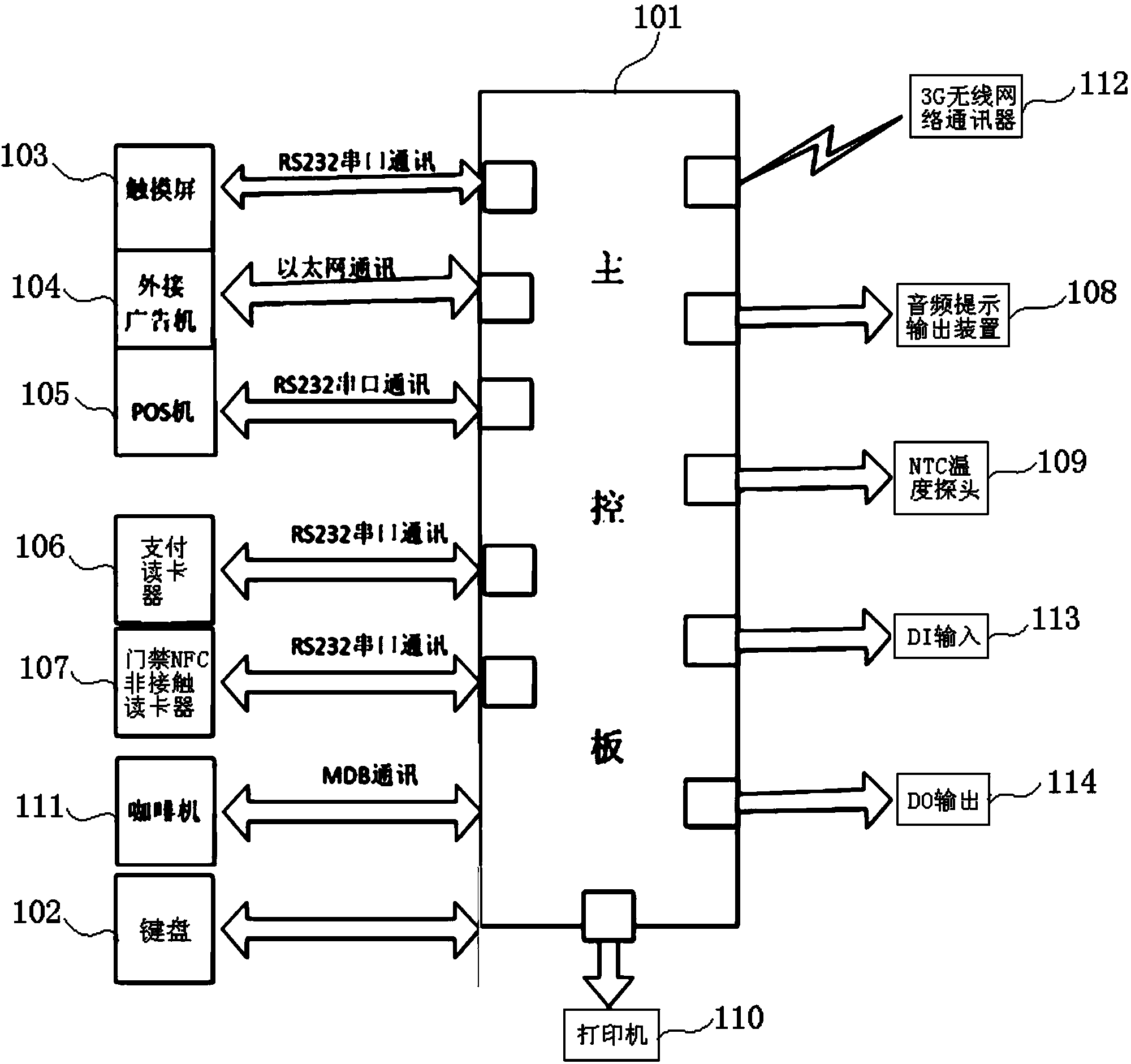

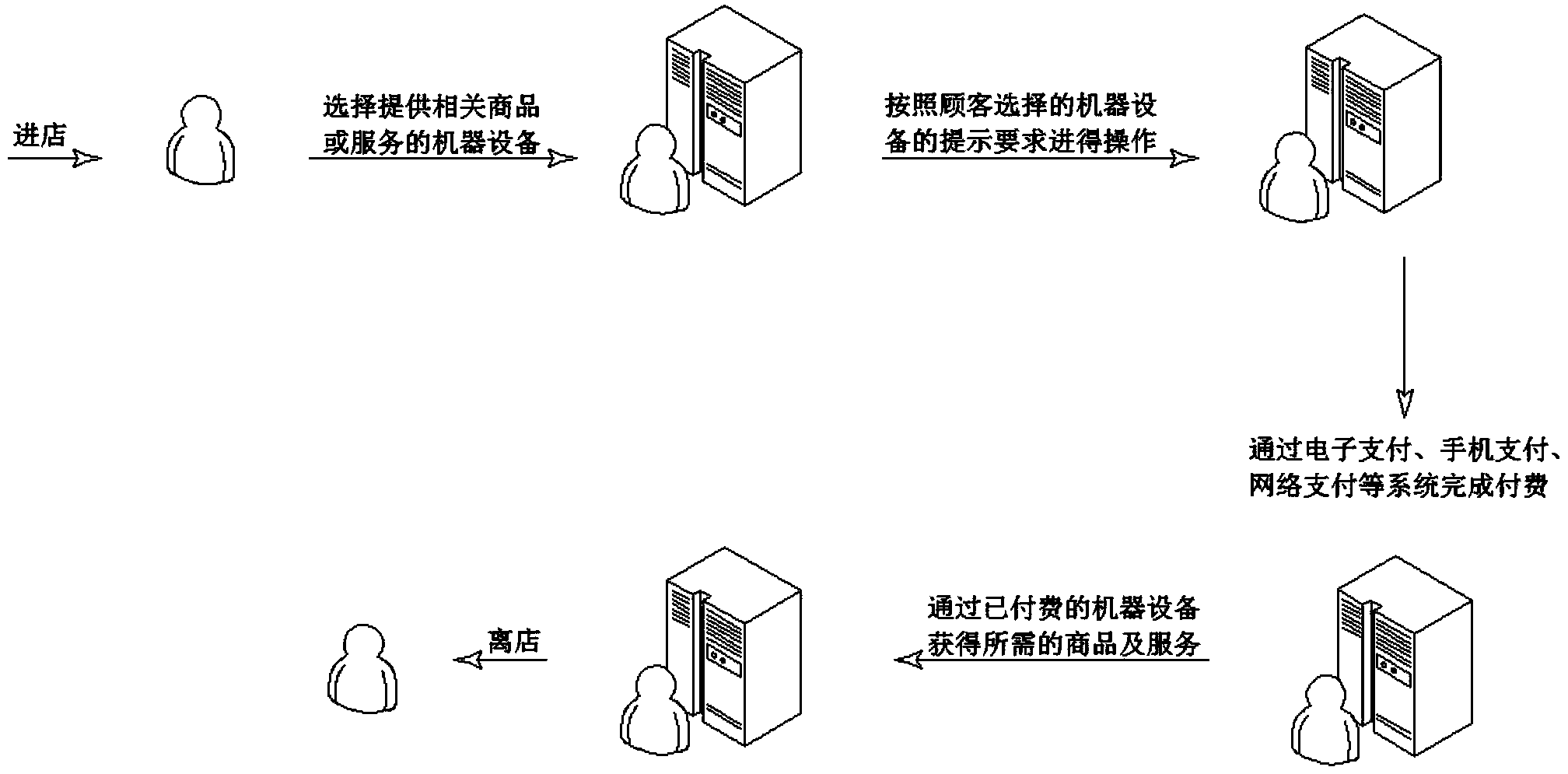

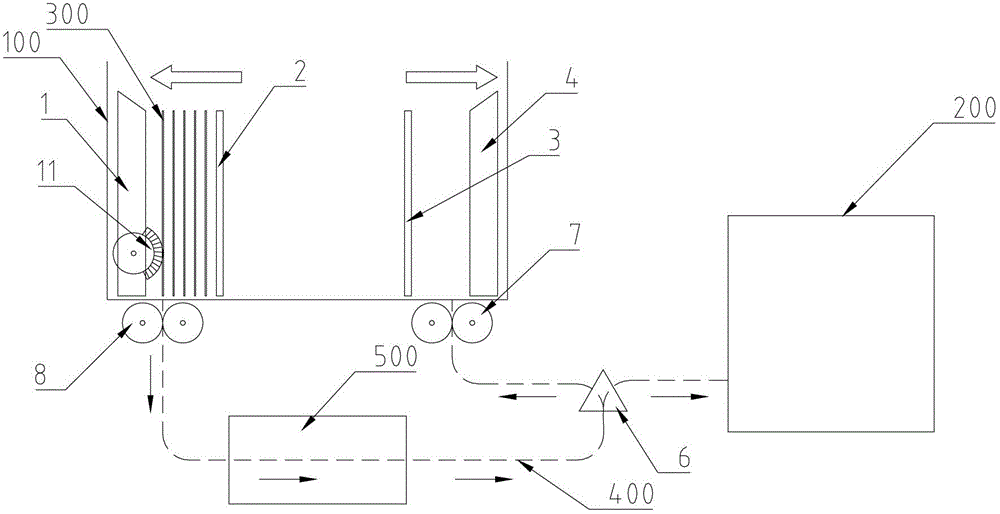

24-hour full intelligent unmanned automatic vending convenience store

InactiveCN103871168AEliminate the trouble of looking for coinsAvoid counterfeit coinsCoin-freed apparatus detailsApparatus for dispensing discrete articlesWirelessRemote system

The invention discloses a 24-hour full intelligent unmanned automatic vending convenience store, which comprises at least one automatic vending machine, communication management equipment and a background server, wherein each automatic vending machine is respectively connected with the communication management equipment in a wireless or wired mode, and the communication management equipment is connected with the background server through Ethernet. The 24-hour full intelligent unmanned automatic vending convenience store has the beneficial effects that the store is opened without area limitation, the personnel guarding is not needed, the operation management cost is reduced, and the condition of personnel property invasion is avoided; a remote system can monitor all operation environment and equipment conditions, in addition, the benign timely regulation and control can be carried out according to requirements, and the energy-saving and environment-friendly requirements are realized in a unified way.

Owner:SHANGHAI CHAOZHAN TRADE

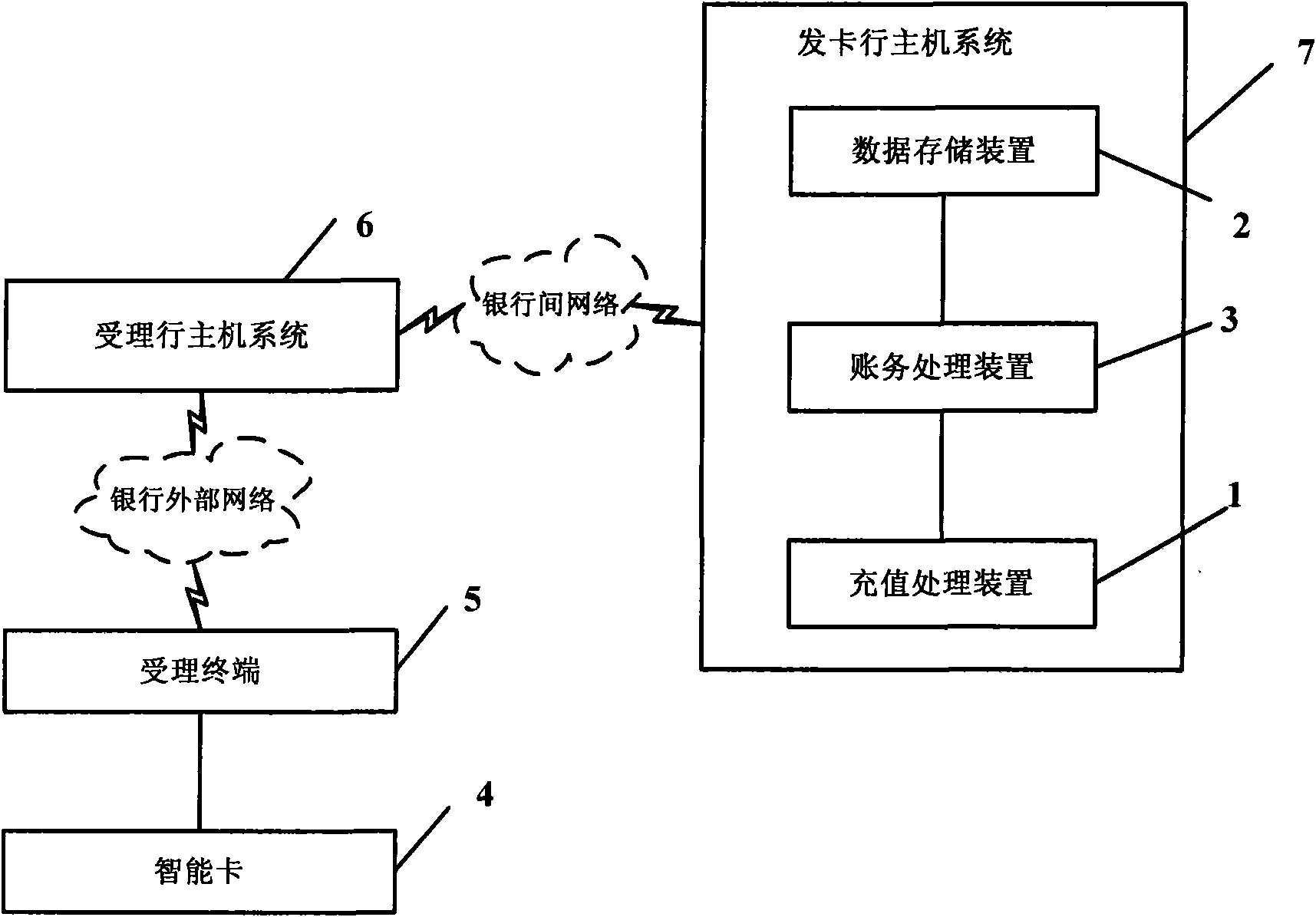

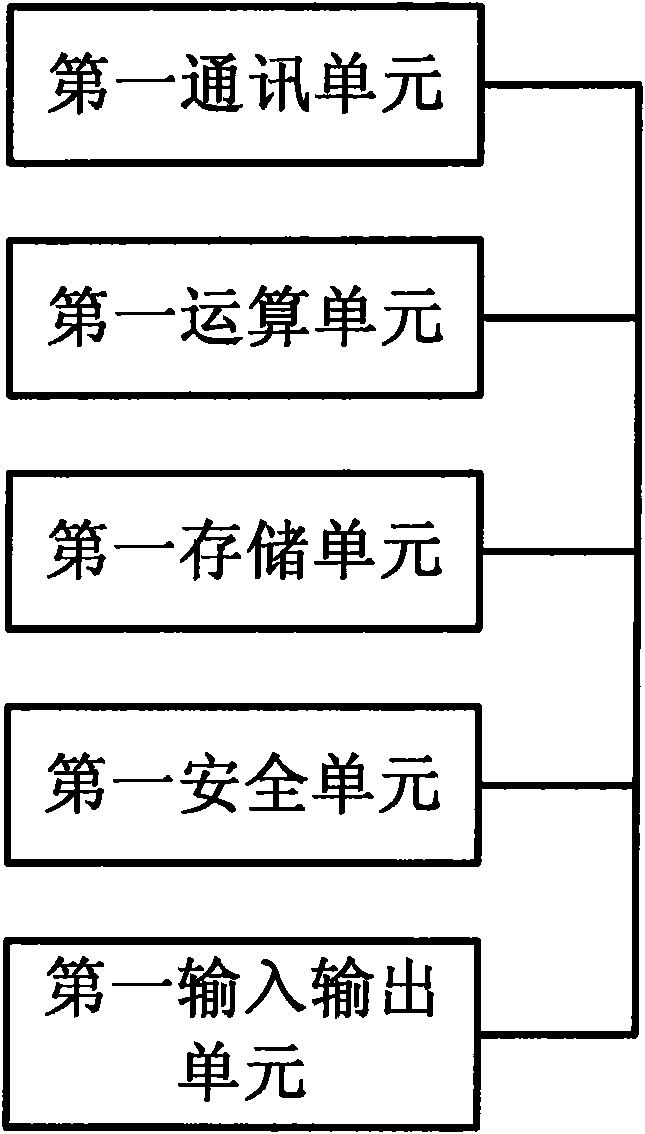

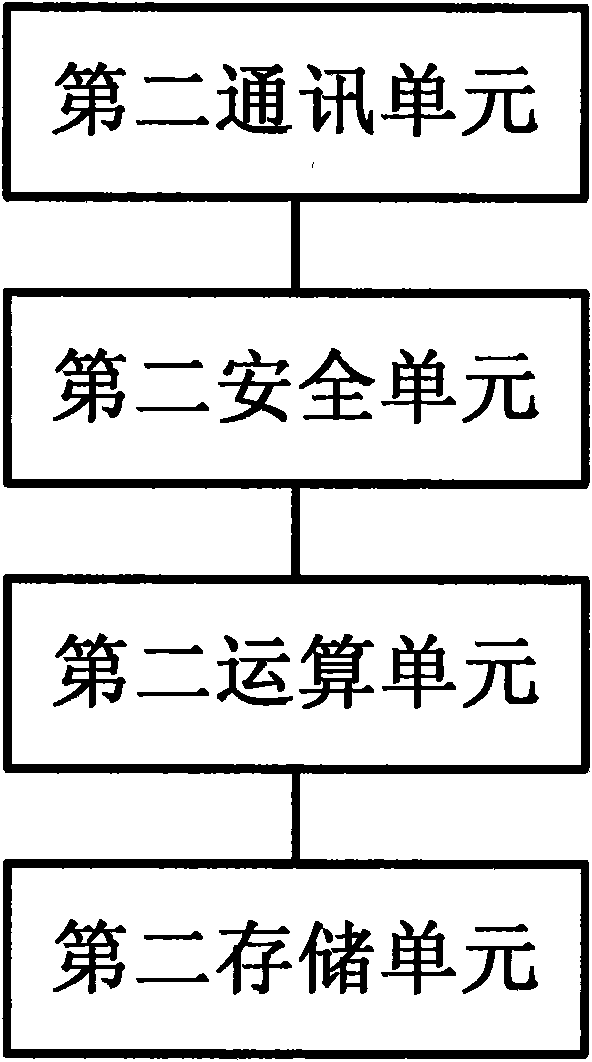

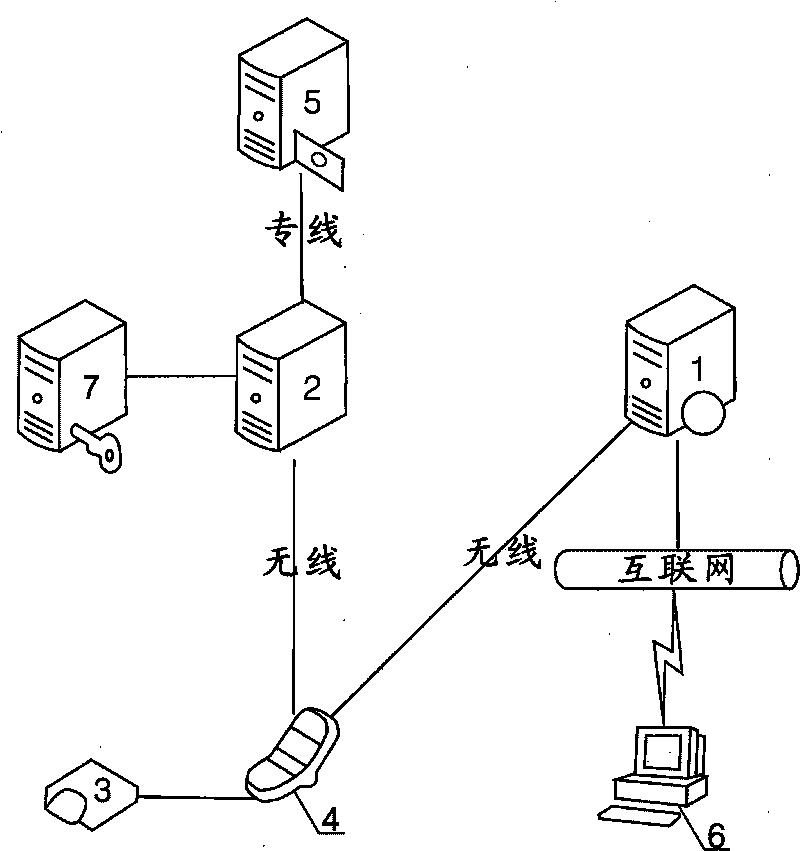

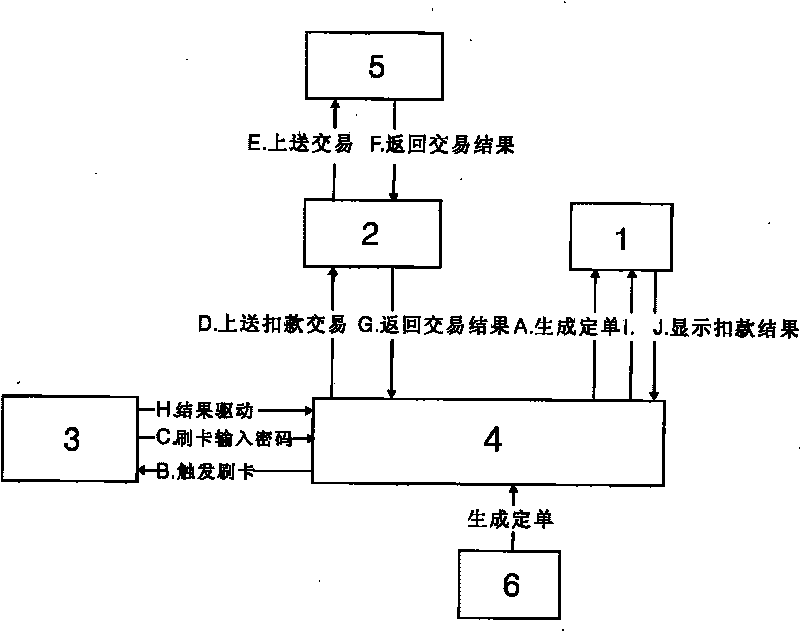

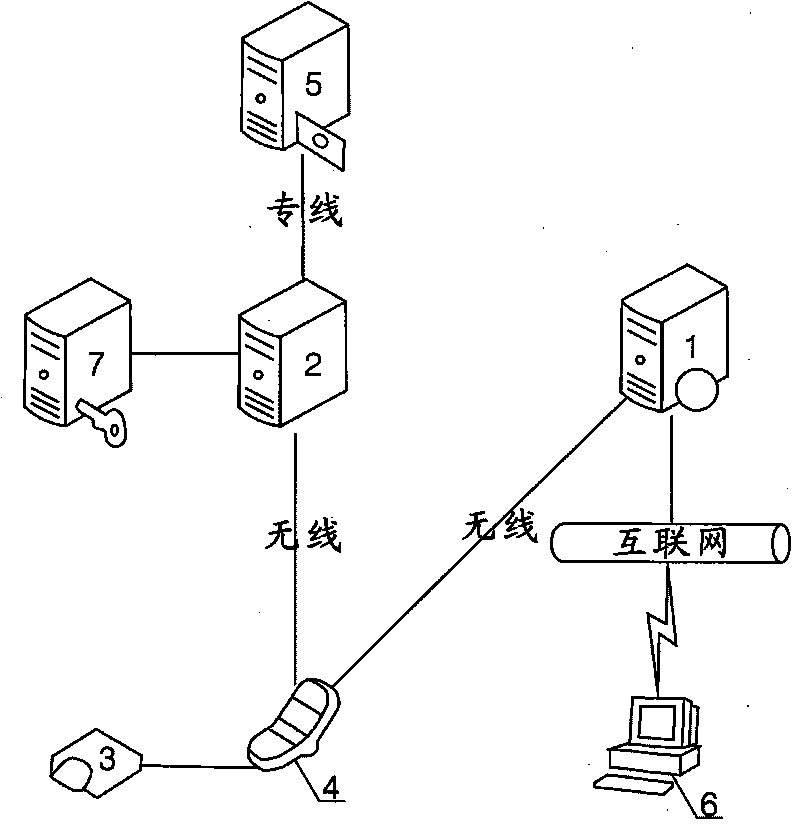

System and method for realizing rapid payment based on bank intelligent card

ActiveCN101923754AGuaranteed to be trueGuaranteed validityComplete banking machinesCoded identity card or credit card actuationIssuing bankComputer terminal

The invention discloses a system for realizing rapid payment based on a bank intelligent card, comprising an issuing bank host system (7), an accepting bank host system (6), an accepting terminal (5) and an intelligent card (4) having the function of rapid and safe payment, wherein the issuing bank host system (7) and the accepting bank host system (6) are connected through an interbank network, the accepting bank host system (6) and the accepting terminal (5) are connected through an external network of a bank, and the accepting terminal (5) and the intelligent card (4) are connected in a contact or noncontact type. The invention simultaneously discloses a method for realizing rapid payment based on the bank intelligent card. The invention overcomes the defects at the aspects of the payment speed, the communication cost and the safety risk of the traditional bank card during payment and has the advantages of rapid transaction, high safety and convenient implementation.

Owner:INDUSTRIAL AND COMMERCIAL BANK OF CHINA

Apparatus and method for integrated payment and electronic merchandise transfer

ActiveUS8196818B2Risk minimizationReduce complexityTransportation facility accessPayment architecturePaymentComputer network

Interrogation of an electronic device by a first terminal is facilitated, to obtain an account number associated with the electronic device. The electronic device is configured according to a payment specification. The first terminal has a first terminal payment module configured according to the payment specification and a first terminal electronic merchandise module configured according to the electronic merchandise infrastructure and coupled to the first terminal payment module to permit transfer of non-payment e-merchandise related information from the first terminal electronic merchandise module to the first terminal payment module. The interrogation of the electronic device is performed by the first terminal payment module. Generation of non-payment e-merchandise related information by the first terminal electronic merchandise module is facilitated. Transfer of the non-payment e-merchandise related information from the first terminal electronic merchandise module to the electronic device via the first terminal payment module, within a transaction between the electronic device and the first terminal payment module that is conducted in accordance with the payment specification, is also facilitated. The non-payment e-merchandise related information is stored on the electronic device in accordance with the payment specification. The electronic device and the first terminal independently calculate a summary data item. The first terminal calculates a first message authentication code based on the non-payment e-merchandise related information and a terminal-calculated value of the summary data item. The non-payment e-merchandise related information is stored on the electronic device together with an electronic device-calculated value of the summary data item and the first message authentication code.

Owner:MASTERCARD INT INC

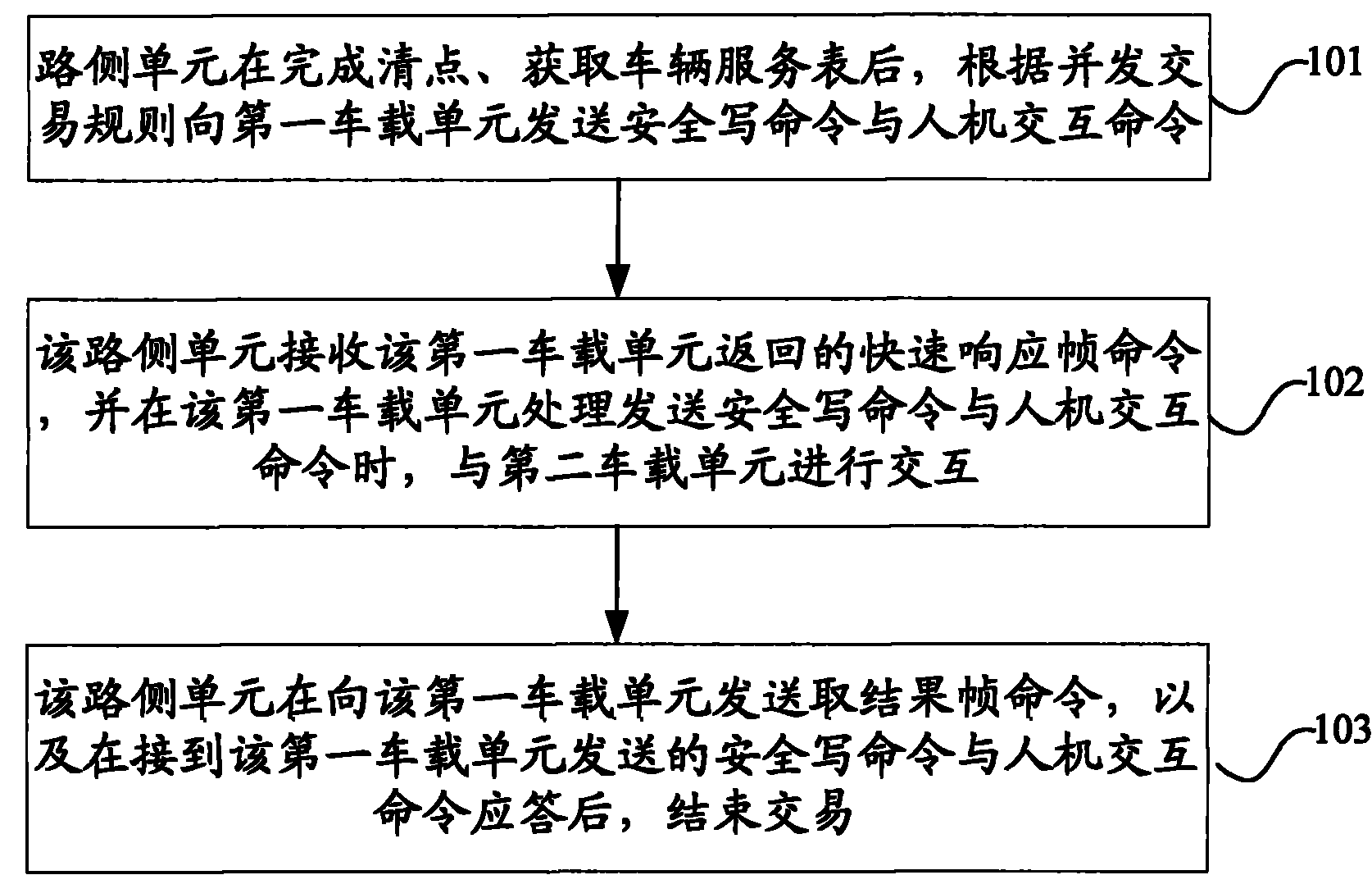

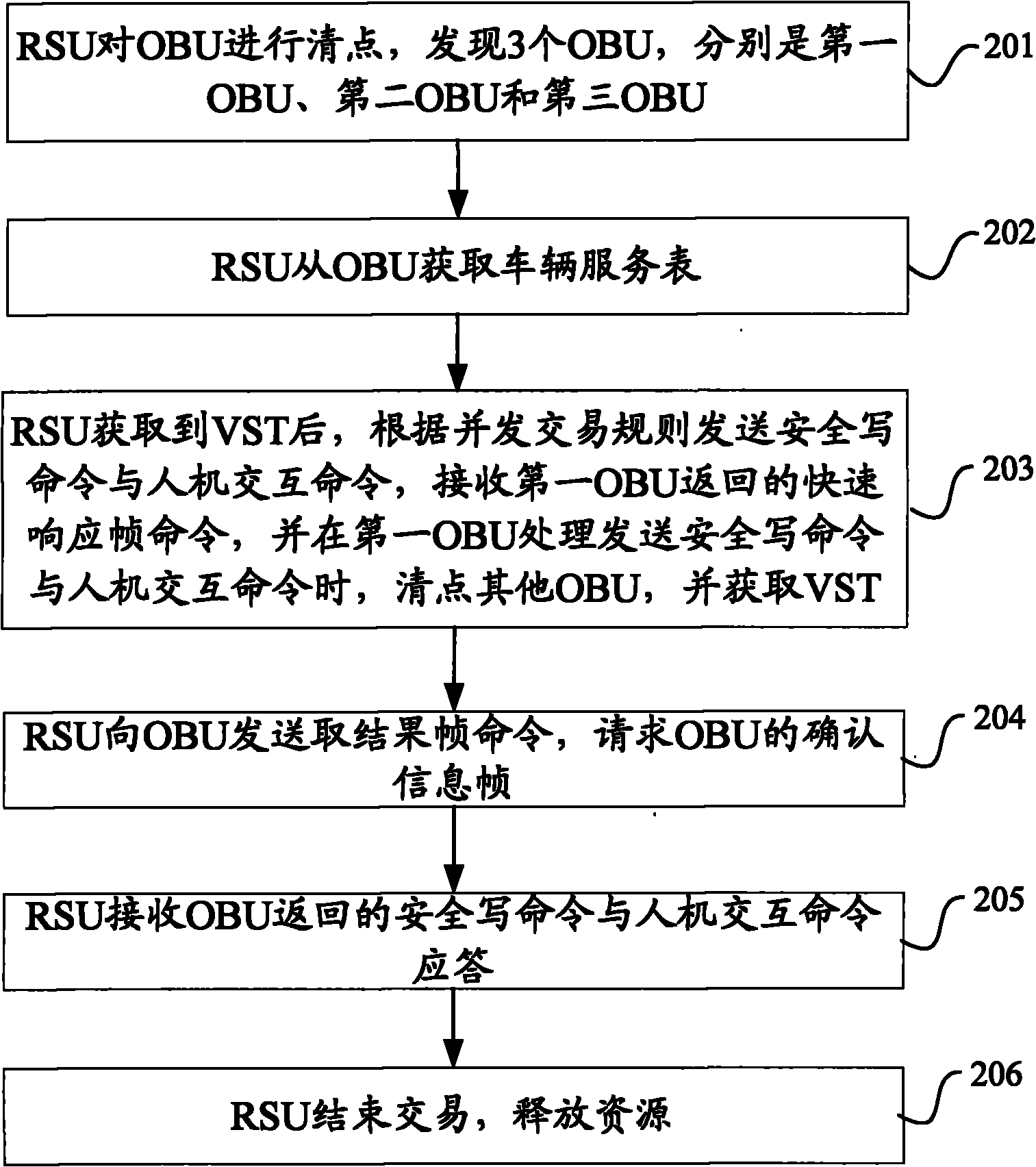

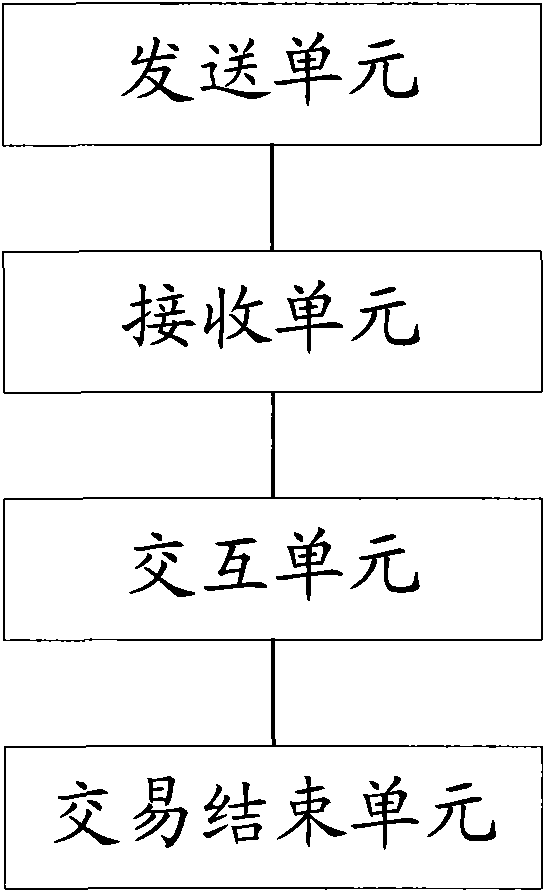

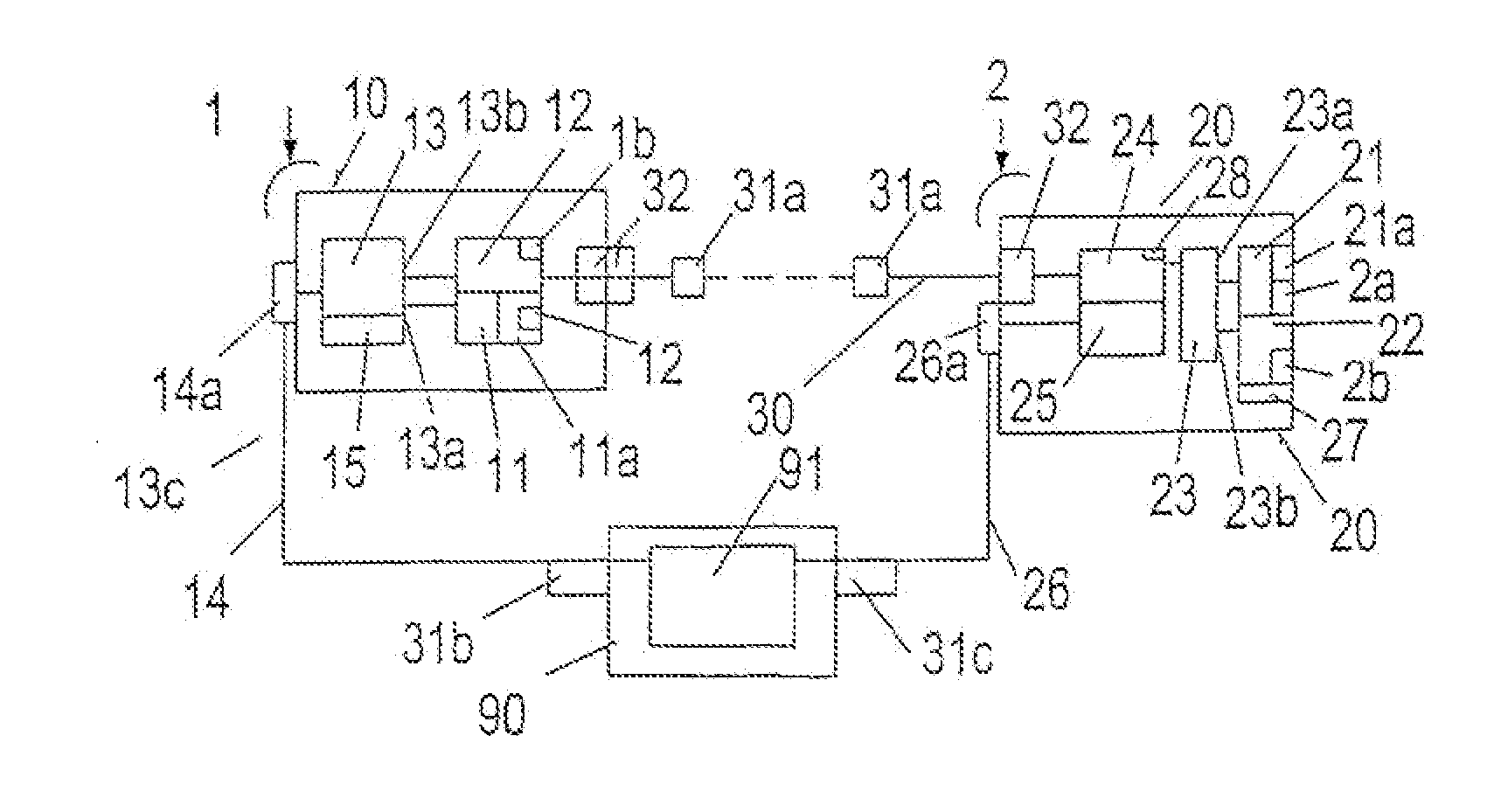

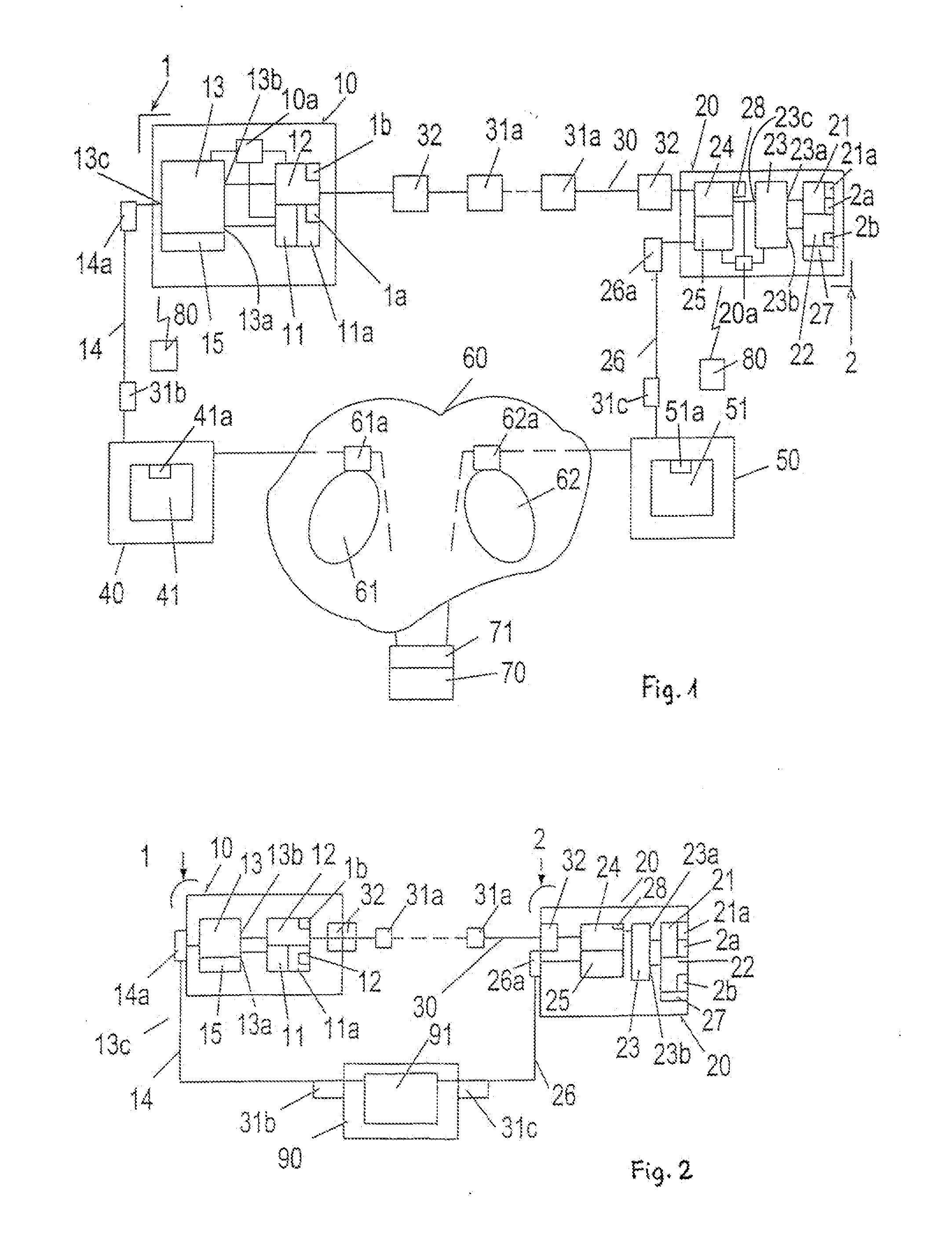

Method and device for realizing electronic toll collection concurrent transaction

InactiveCN102096952AShorten transaction timeTicket-issuing apparatusElectronic toll collection systemHuman–computer interaction

The invention discloses a method and device for realizing electronic toll collection concurrent transaction, relating to the field of electronic toll collection systems. The method comprises the following steps: after finishing checking and obtaining a vehicle service table, a road side unit sends a safe write command and a man-machine interaction command to a first vehicle-mounted unit according to a concurrent transaction rule; the road side unit receives a rapid response frame command returned from the first vehicle-mounted unit and interacts with a second vehicle-mounted unit when the first vehicle-mounted unit processes and sends the safe write command and the man-machine interaction command; and the road side unit sends a result frame fetching command to the first vehicle-mounted unit and ends the transaction after receiving the safe write command and the man-machine interaction command which are sent by the first vehicle-mounted unit. The device comprises a sending unit, a receiving unit, an interacting unit and a transaction ending unit. The technical scheme of the invention can be used for stably realizing electronic toll collection concurrent transaction and shortening the transaction time.

Owner:ZTE CORP

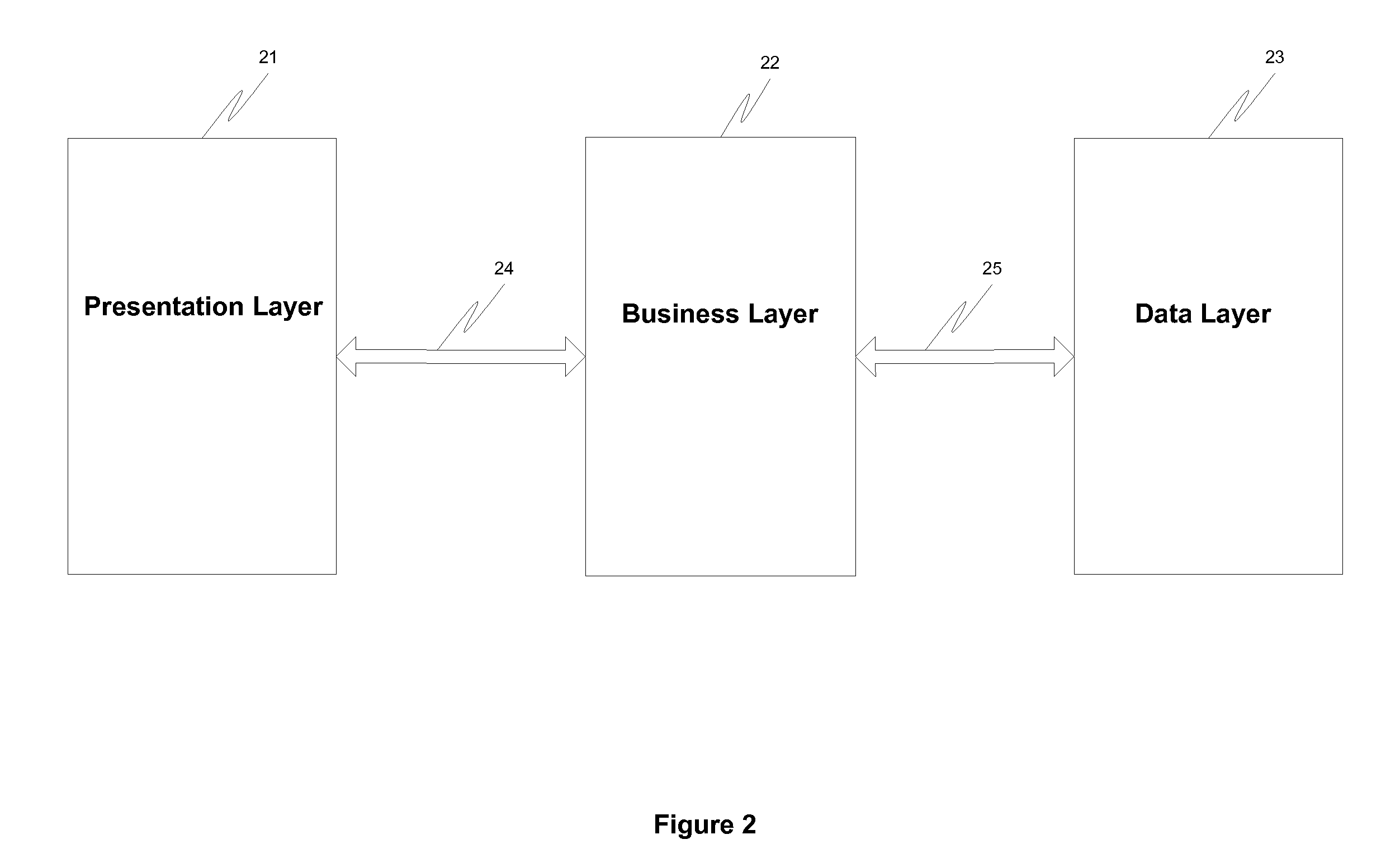

Voice Controlled Business Scheduling System and Method

InactiveUS20070168215A1Improve performanceShorten transaction timeData processing applicationsAutomatic call-answering/message-recording/conversation-recordingOffice administrationOperations research

A fully automated, voice controlled business appointment / reservation system is provided. The system has a natural language voice user interface that emulates a live office administrator for appointment / reservation bookkeeping. It includes an efficient availability searching mechanism which enables a telephone user to quickly search and reserve available time slot based on his preference. Other described novel features and implementation improvements include method and system for voice controlled appointment / reservation cancellation, method and system for voice controlled appointment / reservation waiting list, method and system for new user service sign-up and account creation, method and system enabling sequential selective dialing of a telephone user list by voice command, and method and system for scheduling data administration by voice commands.

Owner:TANG YILISSA

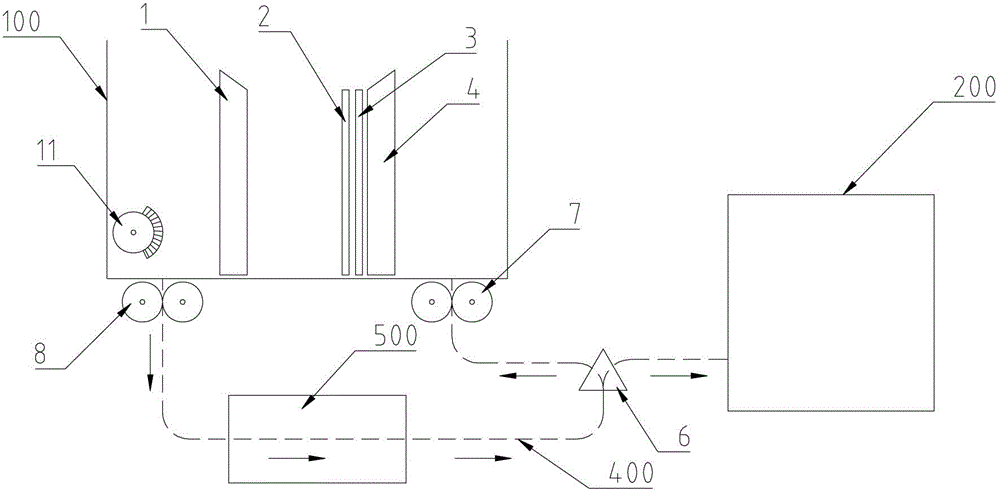

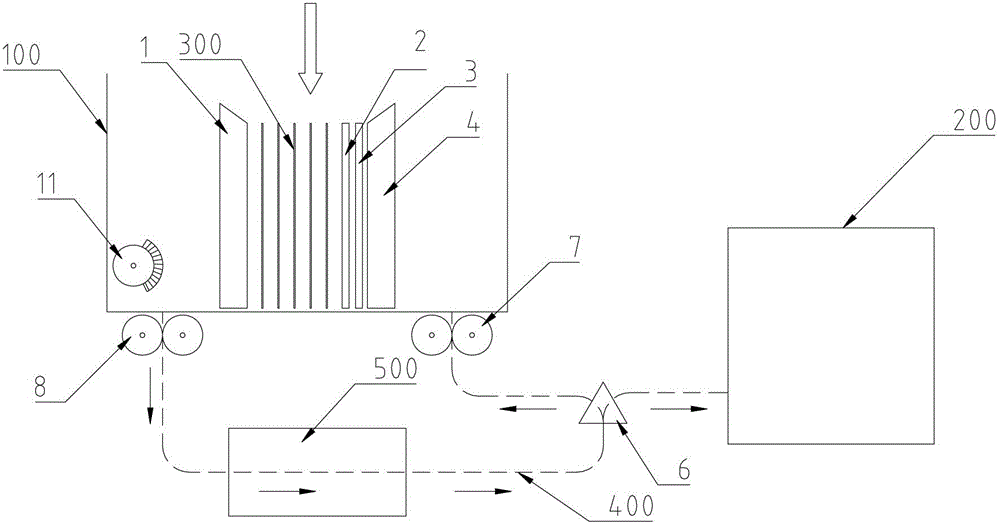

Banknote validation method for ATMs (automatic teller machines)

ActiveCN102915591AReduce the number of deposits and cash withdrawalsImprove efficiencyPaper-money testing devicesValidation methodsEngineering

The invention discloses a banknote validation method for ATMs (automatic teller machines). A banknote validation system for ATMs comprises a deposit and withdrawal unit, a temporary deposit unit, a banknote validation unit and a transfer passage. The deposit and withdrawal unit comprises a retaining plate, a pressure plate, an avoided banknote inlet, a banknote outlet and a banknote digger wheel. The pressure plate is close to the avoided banknote inlet. The retaining plate is close to the banknote outlet. Banknotes to be validated enter the banknote validation unit through the banknote outlet and the front part of the transfer passage. A storage space for banknotes to be validated is reserved between the retaining plate and the pressure plate. Unrecognizable banknotes detected by the banknote validation unit return between the retaining plate and the pressure plate through the rear part of the transfer passage and the avoided banknote inlet and are subjected to re-detection for at least once. The banknote validation system for ATMs allows a customer to place banknote once while the banknotes are detected for multiple times during depositing. The rate of recognizing banknotes placed by the customer each time is increased. The times of the customer depositing and placing the banknotes are decreased, and accordingly opening time of a shutter of the ATM, taking time of the avoided banknotes by the customer, closing time of the ATM and the like are decreased, time for each deposit transaction is decreased and service efficiency of the ATM is improved.

Owner:SHENZHEN YIHUA COMP +2

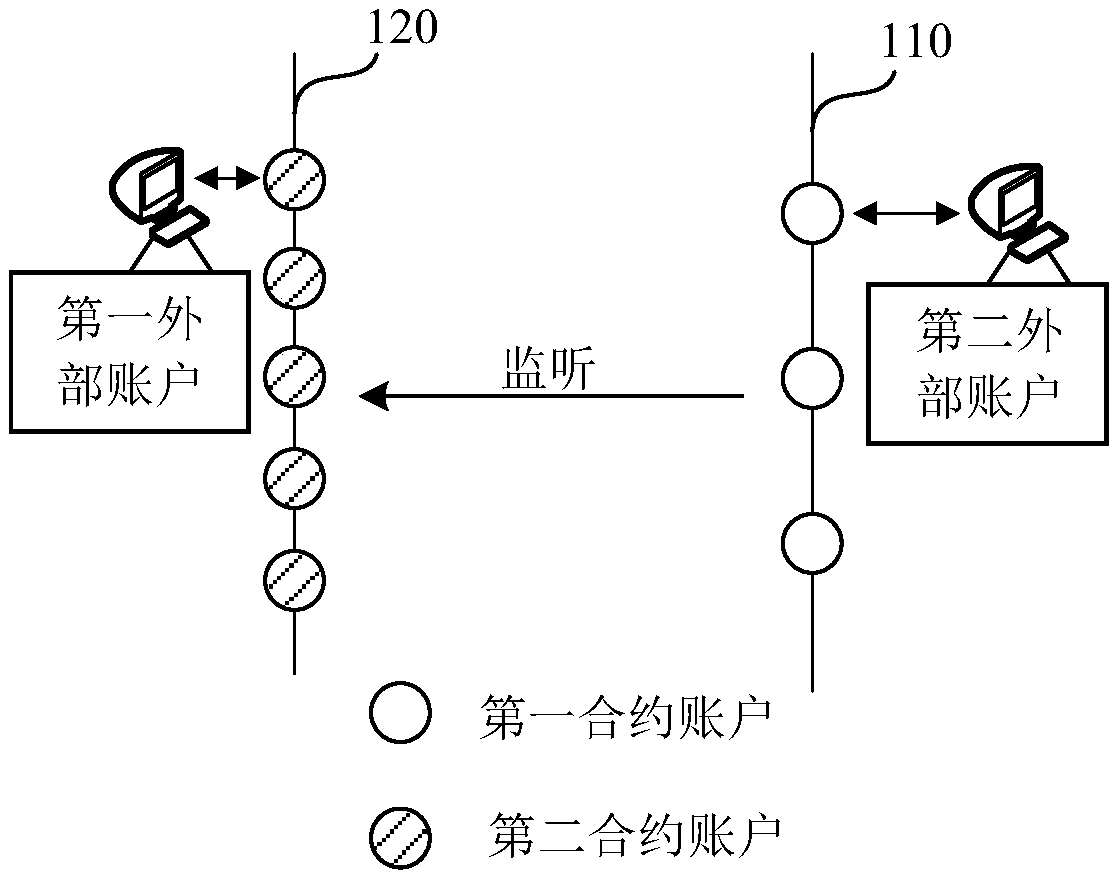

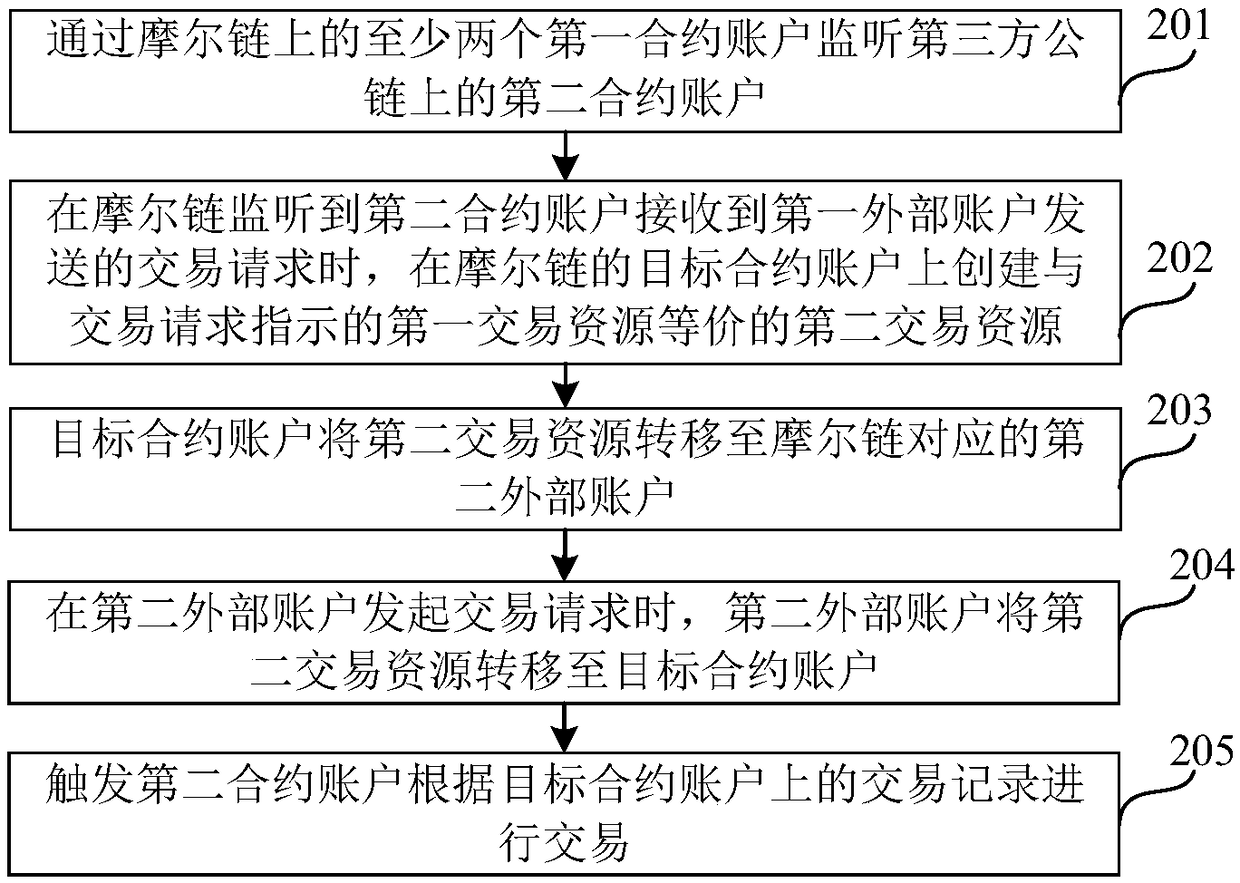

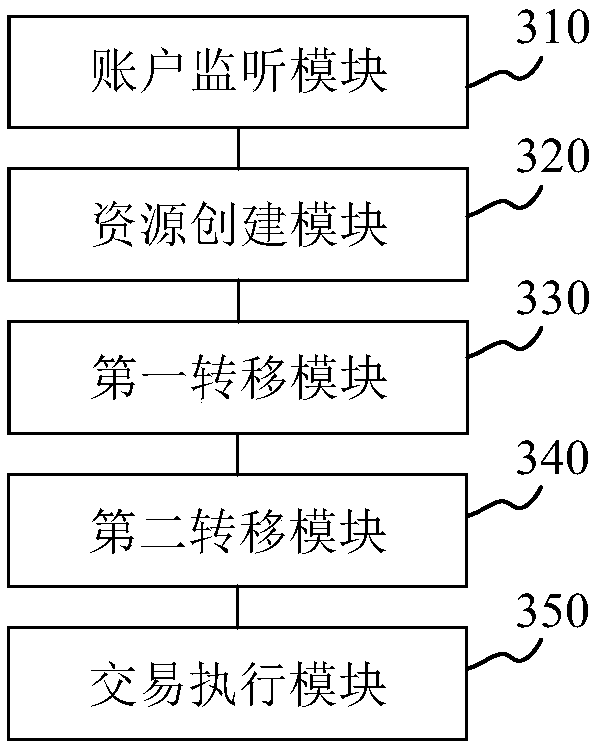

Cross-chain transaction method and device on block chain and storage medium

InactiveCN109409885AShort trading hoursShorten transaction timeFinanceCryptography processingThird partyFinancial transaction

The invention relates to a cross-chain transaction method and device on a block chain and a storage medium, and belongs to the technical field of block chains, and the method comprises the steps: monitoring a second contract account on a third-party public chain through at least two first contract accounts on a mole chain; when the mole chain monitors that the second contract account receives a transaction request sent by the first external account, creating a second transaction resource equivalent to the first transaction resource indicated by the transaction request on a target contract account of the mole chain; the target contract account transfers the second transaction resource to a second external account corresponding to the mole chain; when the second external account initiates atransaction request, the second external account transfers the second transaction resource to the target contract account; Triggering the second contract account to carry out transaction according tothe transaction record on the target contract account; the technical problems that an existing cross-chain transaction needs to consume extra transaction expenses and the transaction time is long canbe solved. The transaction cost of the cross-chain transaction is saved, and the transaction duration of the cross-chain transaction is shortened.

Owner:深圳一声笑科技有限公司

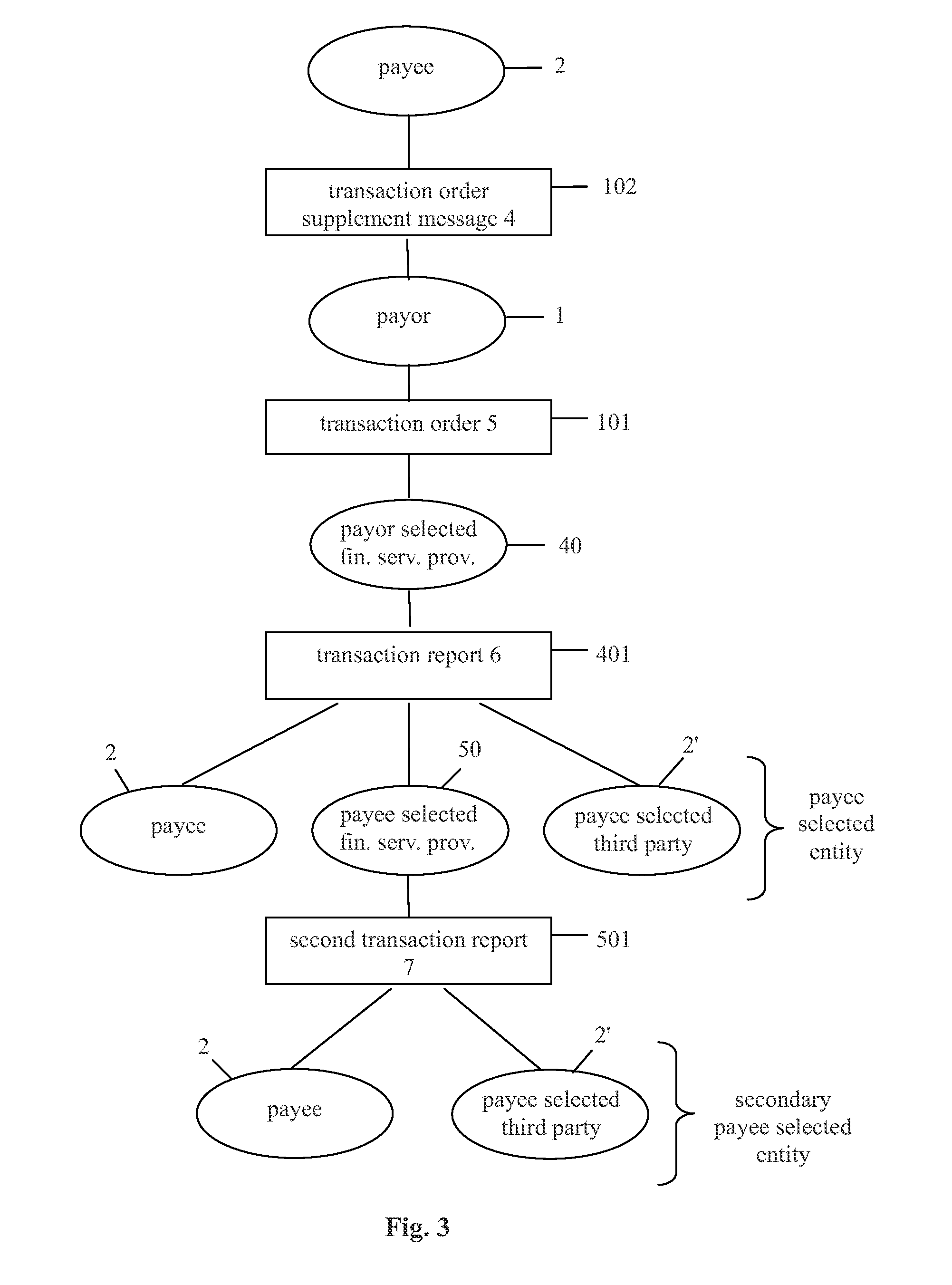

Method for the quasi real-time preparation and consecutive execution of a financial transaction

InactiveUS20120215694A1Overcome disadvantagesShorten transaction timeFinanceDebit schemesFinancial transactionFinancial trading

The present invention relates to a method for the quasi real-time preparation and consecutive execution of a financial transaction between a payor and a payee. The method comprises the steps of:receiving a transaction order by a payor selected financial service provider from the payor;identifying the payor's account based on the transaction order;performing a comparison check of the transaction order and the payor's account, wherein when the comparison check is successful executing a balance transformation on the payor's account in accordance with the transaction order;establishing a communication channel with a payee-selected entity;notifying the payee-selected entity of the result of the balance transformation over the communication channel, andcompleting the financial settlement of the financial transaction.

Owner:VILMOS ANDRAS

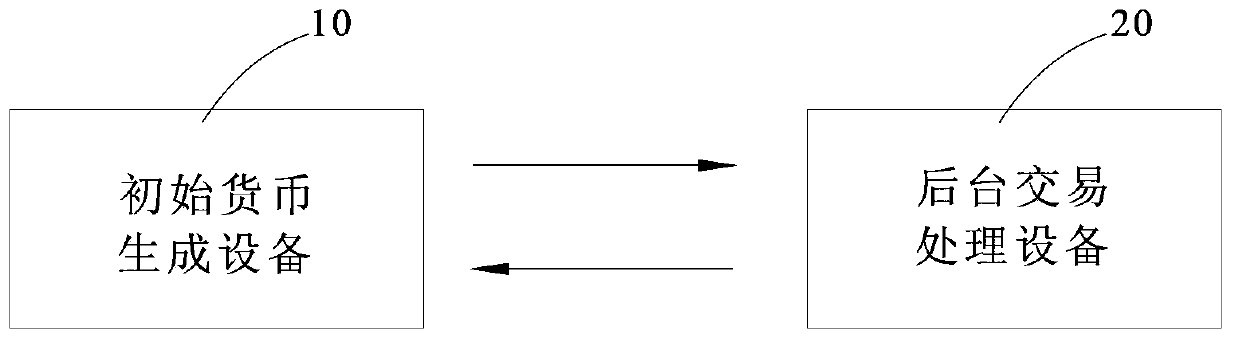

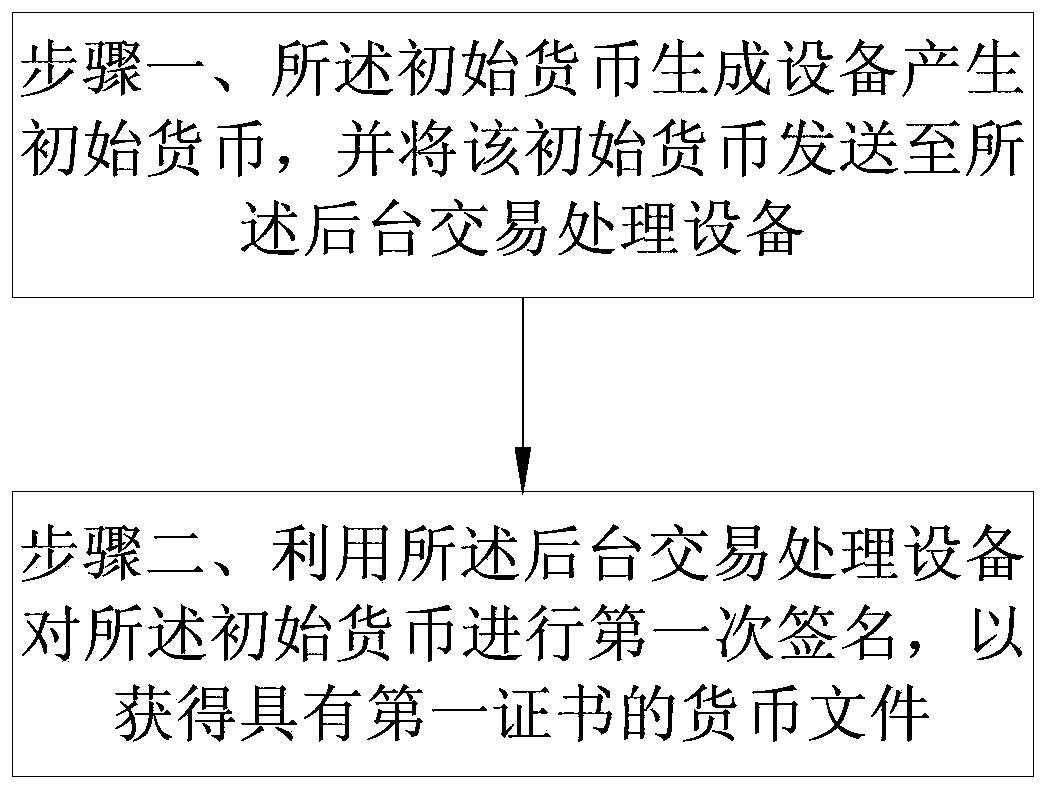

System and method for generating currency file, safety equipment, transaction system and method

ActiveCN103400267AEasy to supervisePrevent forgeryProtocol authorisationDatabaseTransaction processing

The invention provides a system for generating a currency file. A currency file issuing system comprises initial currency generating equipment and background transaction processing equipment, wherein the initial currency generating equipment is used for generating initial currencies; the initial currencies are digital files comprising identification data; the identification data comprise currency denominations; the background transaction processing equipment can sign the initial currencies for the first time to form the currency file with a first certificate; and data participating in the first signature comprise the initial currencies and information of a currency file owner. The invention also provides a method for generating the currency file by using the system, safety equipment, a transaction system comprising the safety equipment and a method for transaction by using the transaction system. According to the transaction method disclosed by the invention, the currency file can be delivered among different sets of safety equipment, and sorting liquidation is not needed, so that the transaction flow is simplified.

Owner:GOLDPAC GRP LTD

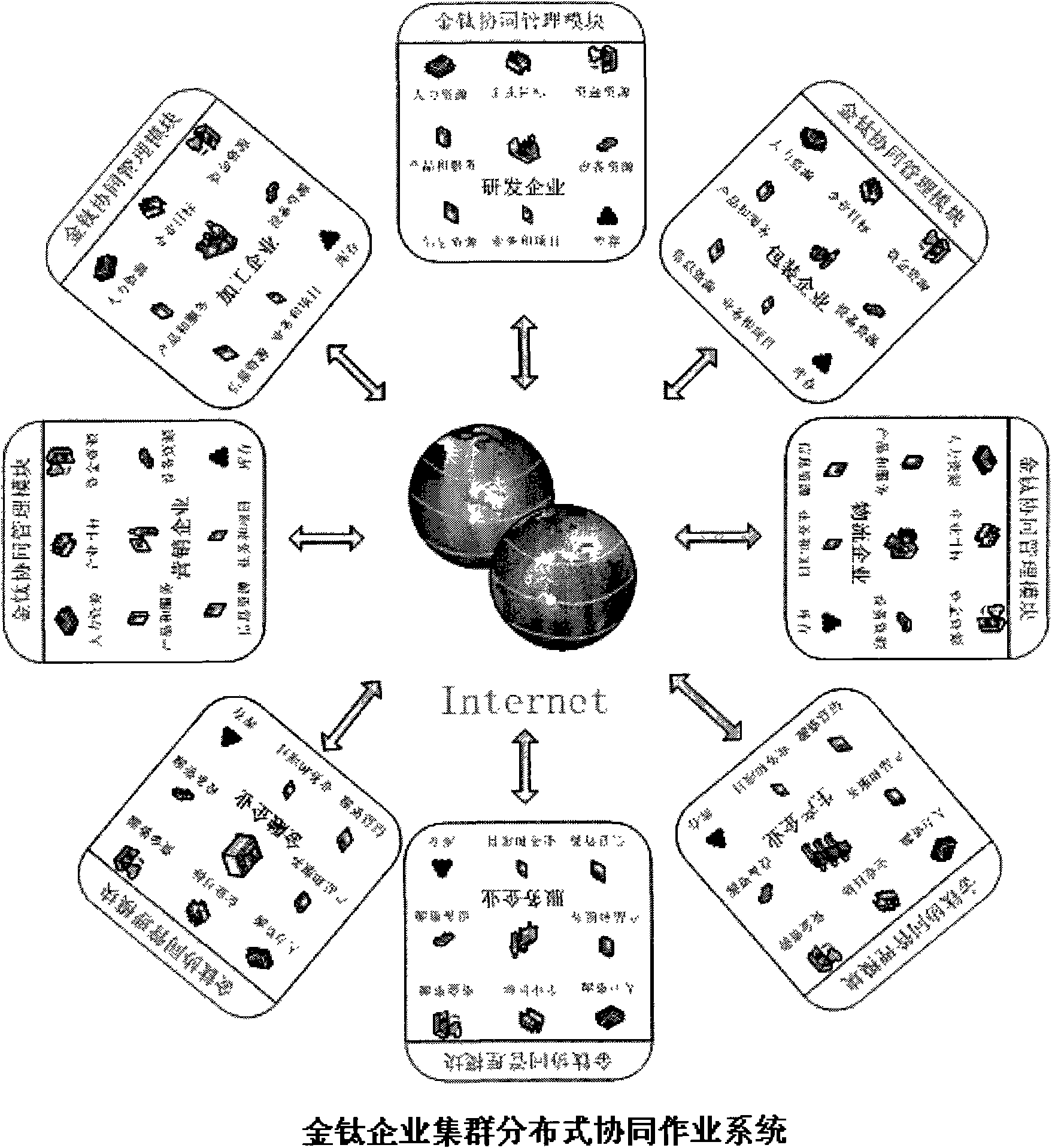

Enterprise cluster distributed cooperative operation system

InactiveCN102142105AImprove securityImprove real-time performanceInstrumentsThe InternetBusiness data

Owner:ZHENJIANG GOLDNT SOFTWARE CORP

Client behavior acquiring and analyzing system and the using method

The invention provides a digital marketing analysis solution with the object of assisting managers to completely analyze the behaviors of their users so as to improve and optimize their website structure, and product performance, and completely improve the sales performance. A system comprises two terminals: a computer terminal and a smart phone terminal. A managing platform comprises a front-end managing part, a member center, a user managing part, a client managing part, a visitor recording and data analyzing part, and an email reminding part. More particularly, the marketing tools comprise V discs and two dimensional codes. The client behavior acquiring and analyzing system of the invention, based on the analysis of enterprise digital business achievements and of the tracking data of visitors and clients from various channels, can help enterprises know about the demands and interest points of an individual person and customer groups and shorten the time to achieve business deals. The system can also analyze the performance of the same trade so as to explore room and chance for development and to help enterprises know about the effect of digital promotion and the optimization direction.

Owner:SHENYANG SIZHE DATA TECH CO LTD

Systems and methods for convenient and secure mobile transactions

ActiveUS9276910B2Shorten transaction timeImprove convenienceCryptography processingBuying/selling/leasing transactionsComputer terminalMobile transaction

Systems and methods for conducting convenient and secure mobile transactions between a payment terminal and a mobile device, e.g., in a fueling environment, are disclosed herein. In some embodiments, the payment terminal and the mobile device conduct a mutual authentication process that, if successful, produces a session key which can be used to encrypt sensitive data to be exchanged between the payment terminal and the mobile device. Payment and loyalty information can be securely communicated from the mobile device to the payment terminal using the session key. This can be done automatically, without waiting for the user to initiate a transaction, to shorten the overall transaction time. The transaction can also be completed without any user interaction with the mobile device, increasing the user's convenience since the mobile device can be left in the user's pocket, purse, vehicle, etc.

Owner:WAYNE FUELING SYST

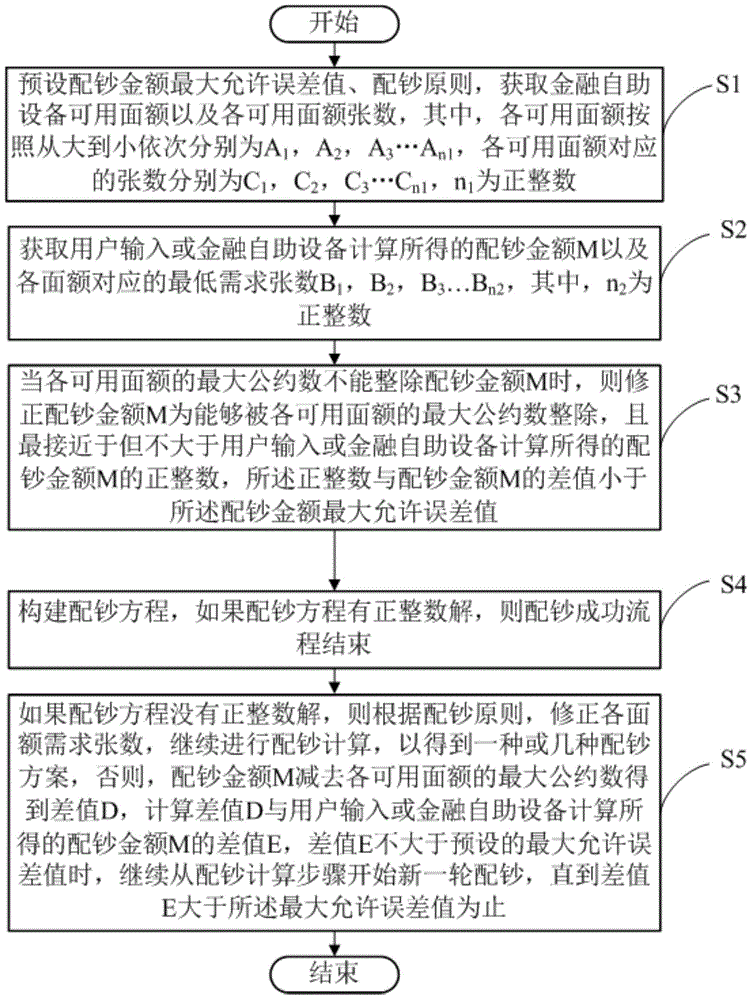

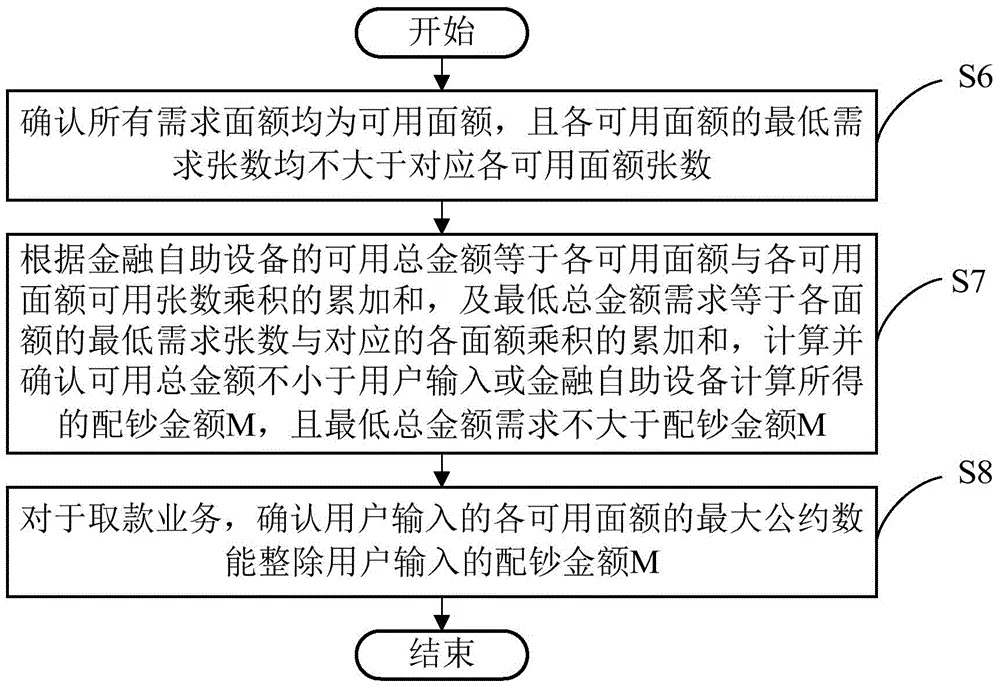

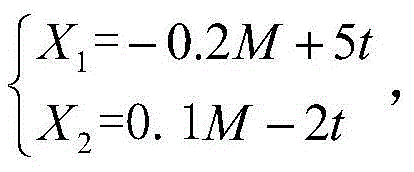

Cash distribution method for financial self-service equipment

InactiveCN104809826AMeet actual needsReduce lossesComplete banking machinesUser needsDistribution method

The embodiment of the invention discloses a cash distribution method for financial self-service equipment. The method comprises an initializing step, a user demand data acquiring step, a cash distribution amount correcting step, a cash distribution calculating step and a nominal amount demand sheet correcting and redistributing step. In the embodiment of the invention, a cash distribution algorithm for correcting the cash distribution amount and the demanded sheet of each nominal amount is adopted, so that the highest closeness to the cash distribution amount is ensured preferably, the sheet demand of each nominal amount of the user is met to the maximum extent, the fund loss of a user is reduced, the transaction time is saved, and the degree of satisfaction is increased; in particular, the problem of cash distribution with requirement on the nominal mount in foreign currency exchange and large-denomination exchange is solved, the current resources of the financial self-service equipment are utilized rapidly, and the user demand is met to the maximum extent.

Owner:SHENZHEN YIHUA TIME TECH +2

Mobile webpay system and realization method thereof

InactiveCN101694736AGet rid of constraintsLow costFinanceCash registersWireless mesh networkCash collection

The invention provides a mobile webpay system and a realization method thereof. The system comprises a webpay terminal consisting of transaction equipment and wireless communication equipment, a management website realizing the man-machine interaction between the system and a user and a card transaction front system, wherein the user visits the management website by using a browser of a PC through the internet; the management website is wirelessly connected with the wireless communication equipment; the wireless communication equipment and the transaction equipment are connected with a Bluetooth, serial port or USB in between; the transaction equipment is driven by a client program of the wireless communication equipment; the wireless communication equipment communicates with the card transaction front system through the wireless network; and the card transaction front system communicates with a card transaction background processing system through a DDN dedicated wire. The invention can realize the integrated functions of cash collection, money transfer and capital accumulation through the mobile webpay and has the advantages of quick transaction, wide application and no place limit.

Owner:GUANGDONG JUNXIANG BUSINESS SERVICE

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com