Patents

Literature

1376 results about "Payment terminal" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

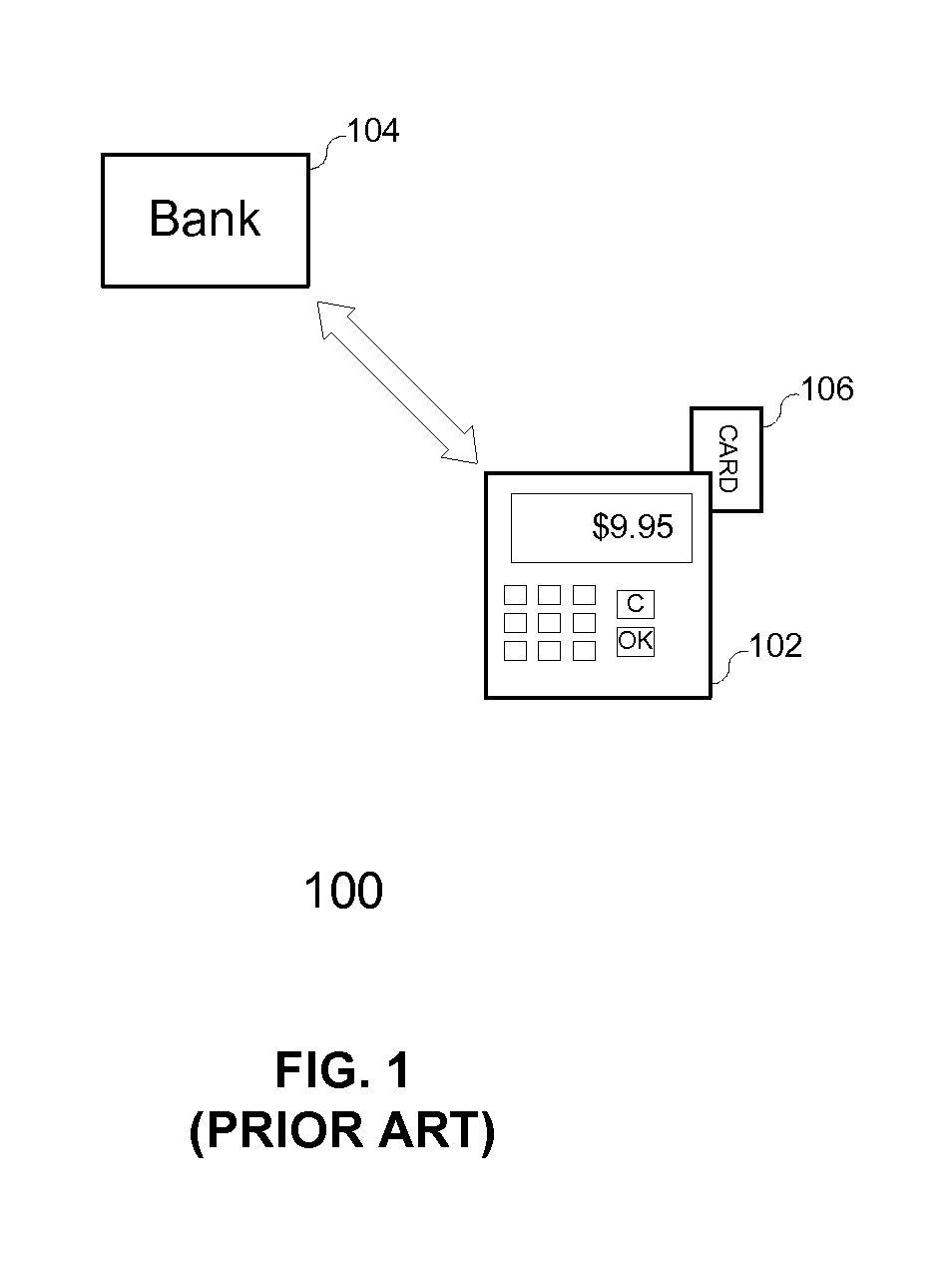

A payment terminal, also known as a Point of Sale (POS) terminal, credit card terminal, EFTPOS terminal (or by the older term as PDQ terminal which stands for "Process Data Quickly" or in common jargon as "Pretty Damn Quick"), is a device which interfaces with payment cards to make electronic funds transfers. The terminal typically consists of a secure keypad (called a PINpad) for entering PIN, a screen, a means of capturing information from payments cards and a network connection to access the payment network for authorization.

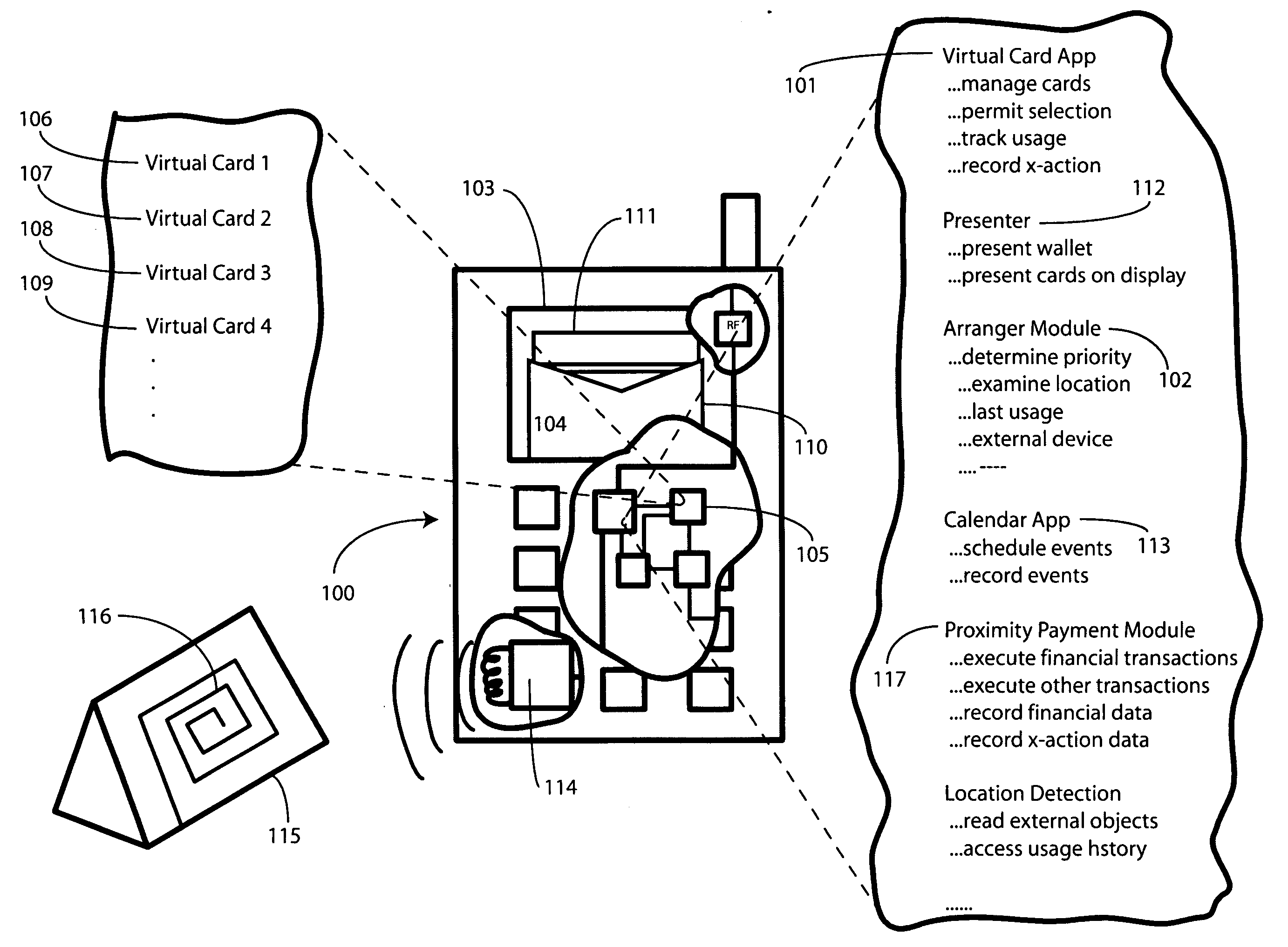

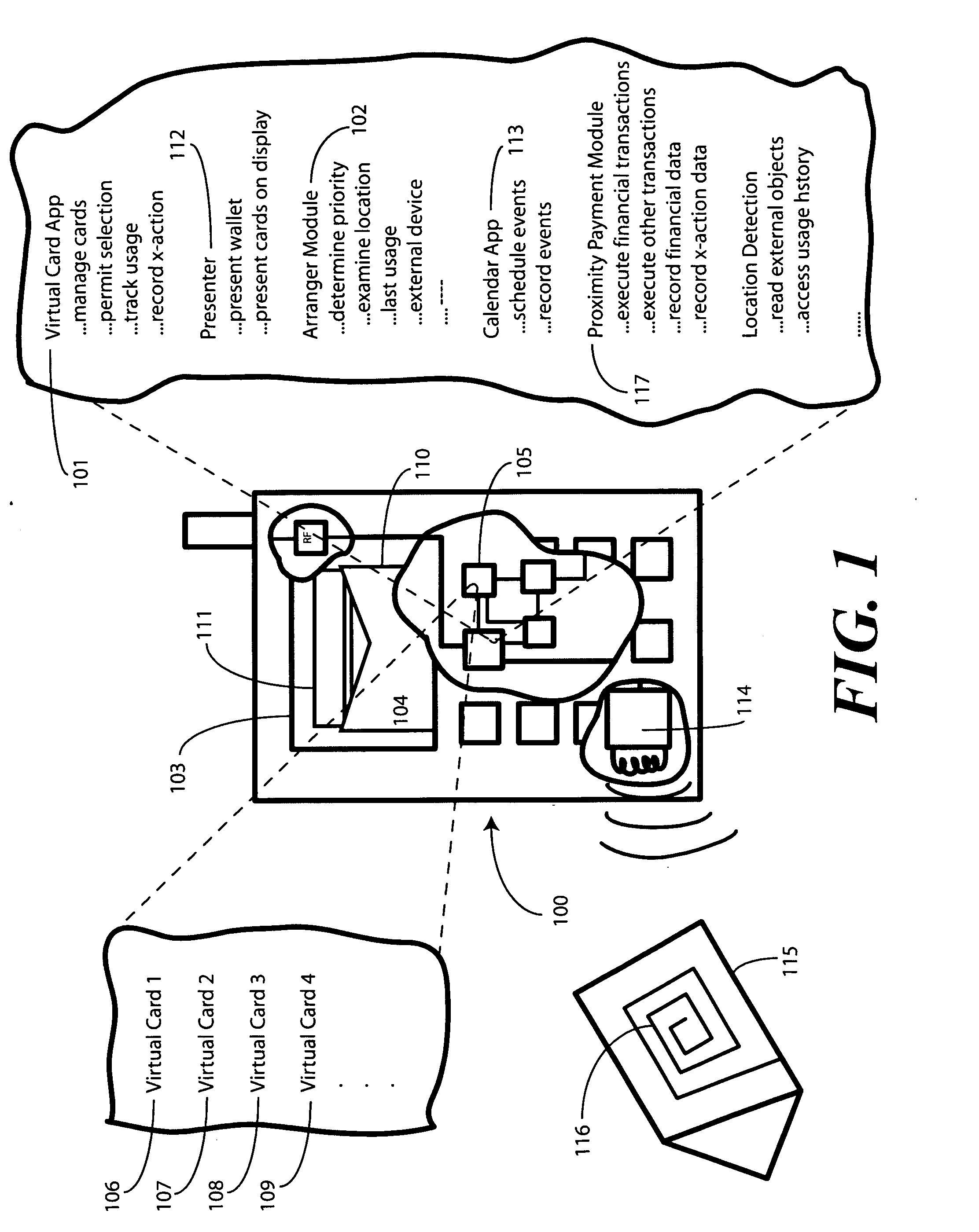

Virtual Card Selector for a Portable Electronic Device

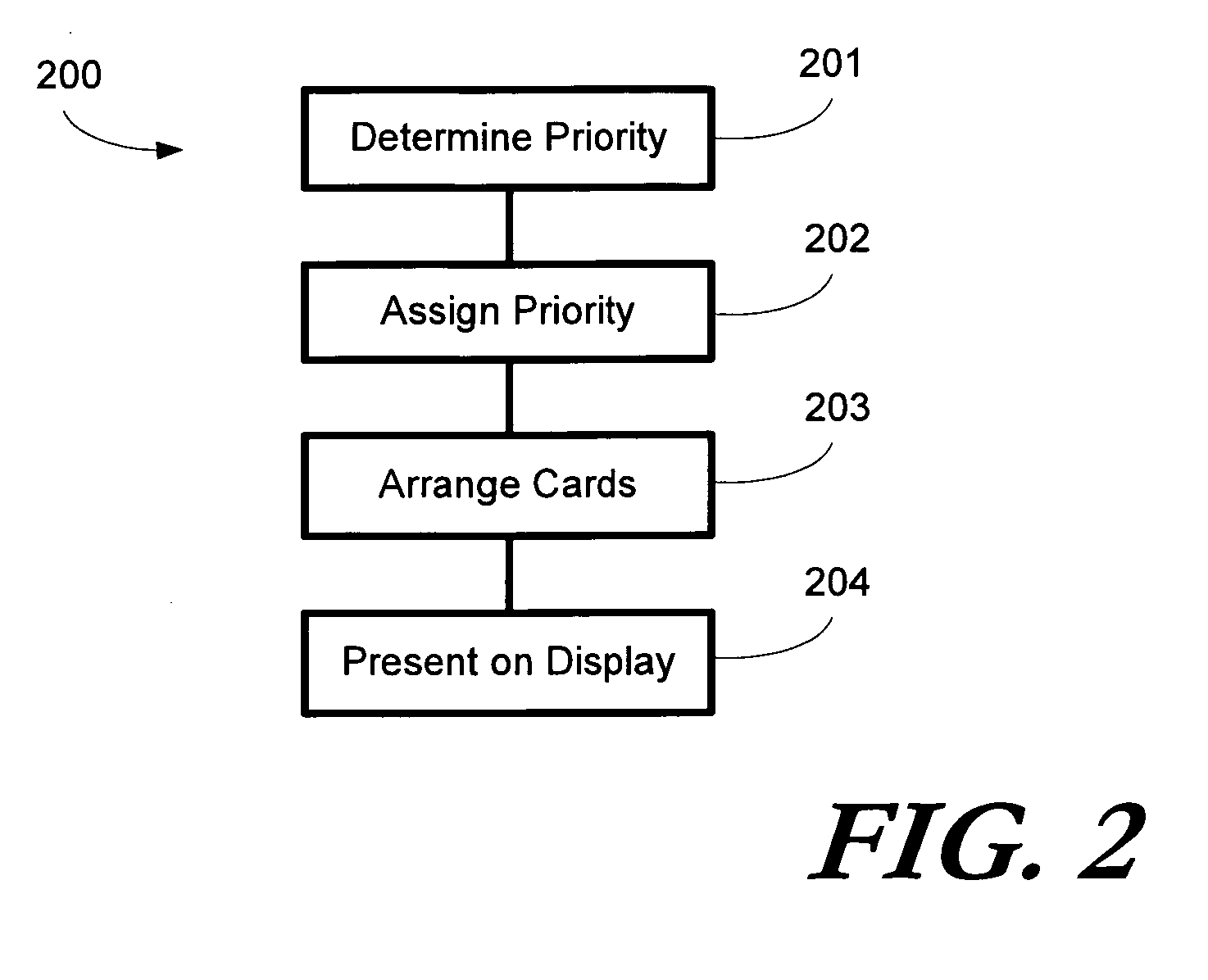

A portable electronic device (100), such as a mobile telephone, portable computer, personal digital assistant, or other similar device, is equipped with a virtual card application (101) configured to manage a plurality of virtual cards (106,107,108,109). Such virtual cards (106,107,108,109) are used in financial and other transactions by way of a wireless near-field transceiver (114) and a near-field communication terminal, such as a payment terminal (115). To provide a user with a seamless, less complex virtual card selection process, an arranger module (102) is configured to determine a priority associated with each of the virtual cards (106,107,108,109). The priority may be determined from location, schedule, calendar, user input, or other means. Once the priority is determined, the virtual card with the foremost priority is advanced as a top of the wallet card (111). The top of the wallet card (111), in one embodiment, is the default card for use in the transaction.

Owner:MOTOROLA INC

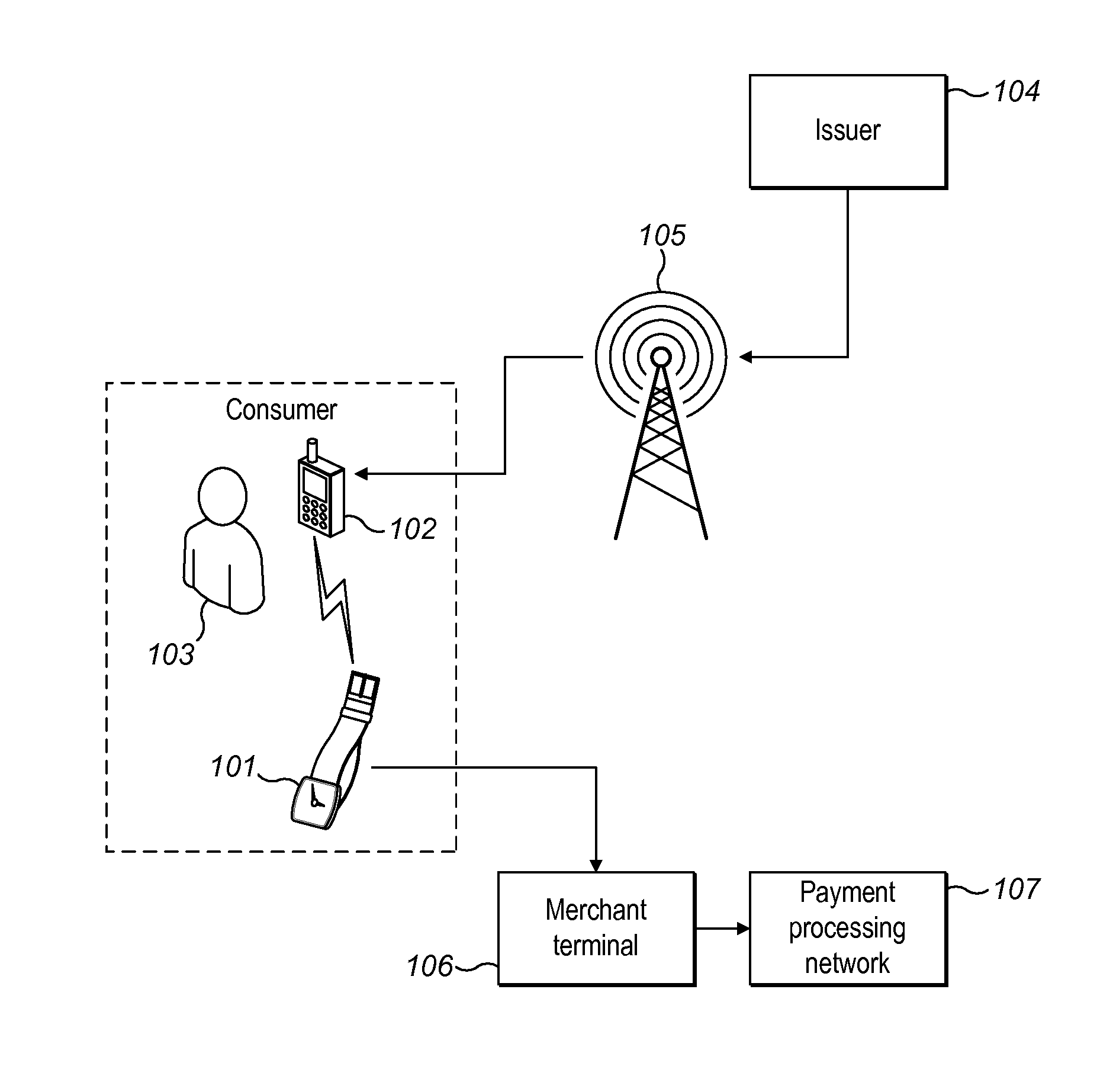

Paired wearable payment device

InactiveUS20150039494A1Easy data transferFinancePayment architecturePayment transactionComputer terminal

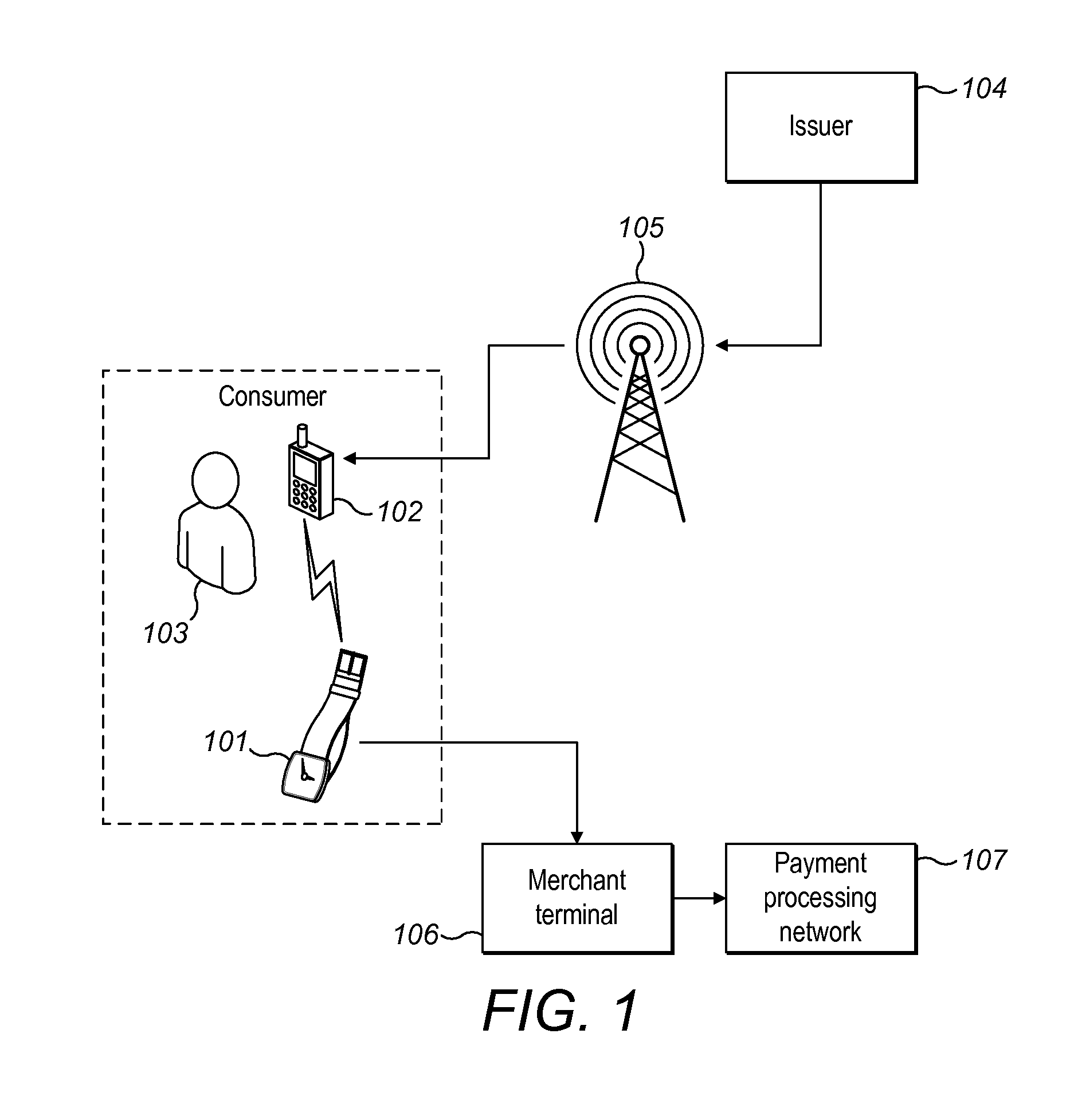

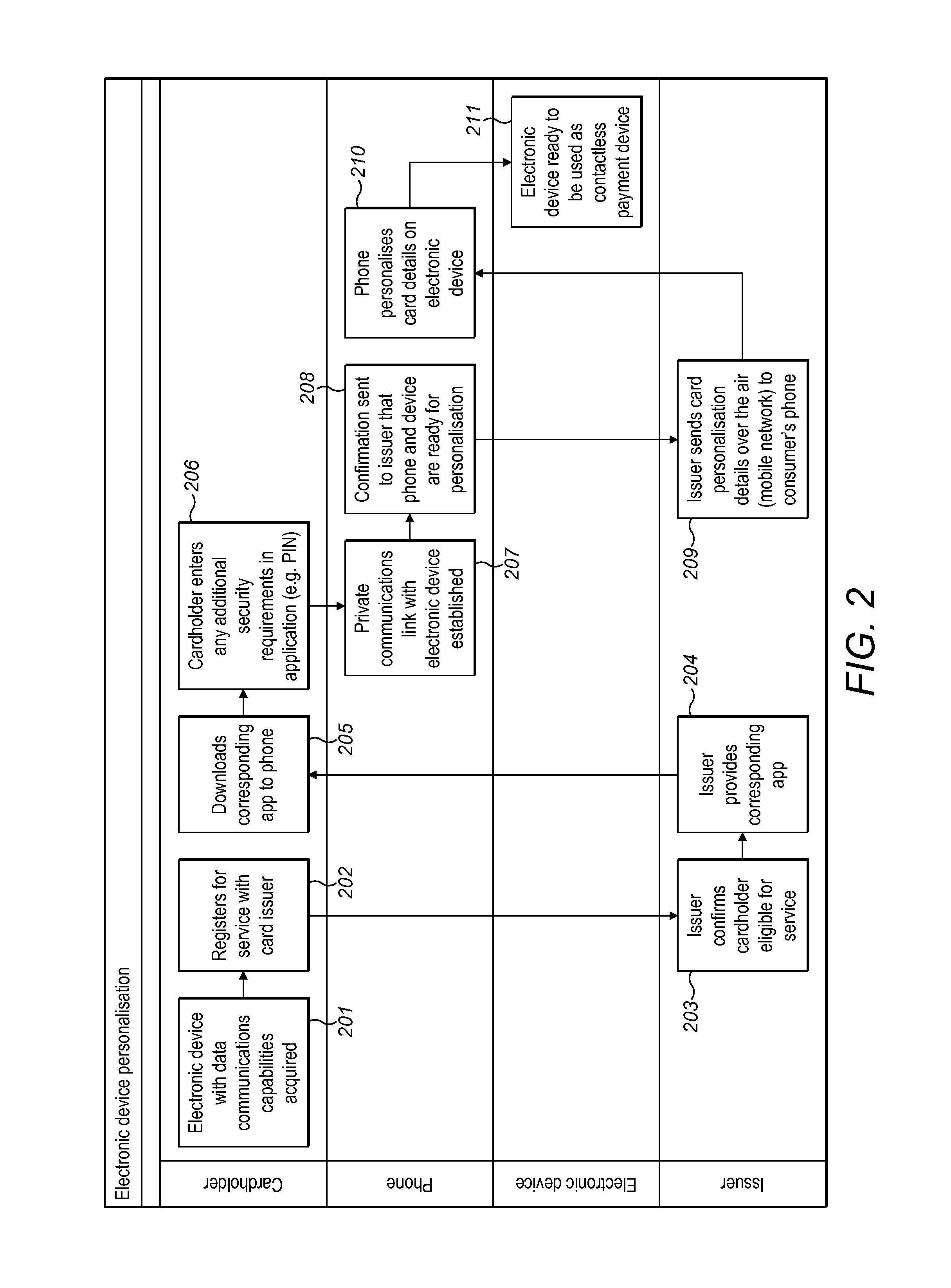

The present invention relates to an electronic device 101 for use in a transaction process. The electronic device 101 comprises a first wireless communication module for communicating with a second electronic device 102 and a second wireless communication module for communicating with a payment terminal 106 for the purpose of performing a payment transaction. The electronic device 101 is capable of relaying data between the second device 102 and the payment terminal 106. A method of performing a transaction is also disclosed, said method comprising the following steps. Firstly, a first wireless communication between an electronic device 101 and a second electronic device 102 is established. Secondly, transaction details required to perform a contactless transaction are uploaded from the second electronic device 102 to the electronic device 101 and securely stored on the electronic device 101. Thirdly a second wireless communication between the electronic device 101 and a payment terminal 106 is established. Finally, the payment terminal 106 is provided with the transaction details.

Owner:MASTERCARD INT INC

POS payment terminal and a method of direct debit payment transaction using a mobile communication device, such as a mobile phone

InactiveUS20110112968A1Solve insufficient capacityImprove security levelAcutation objectsAccounting/billing servicesDirect debitPayment transaction

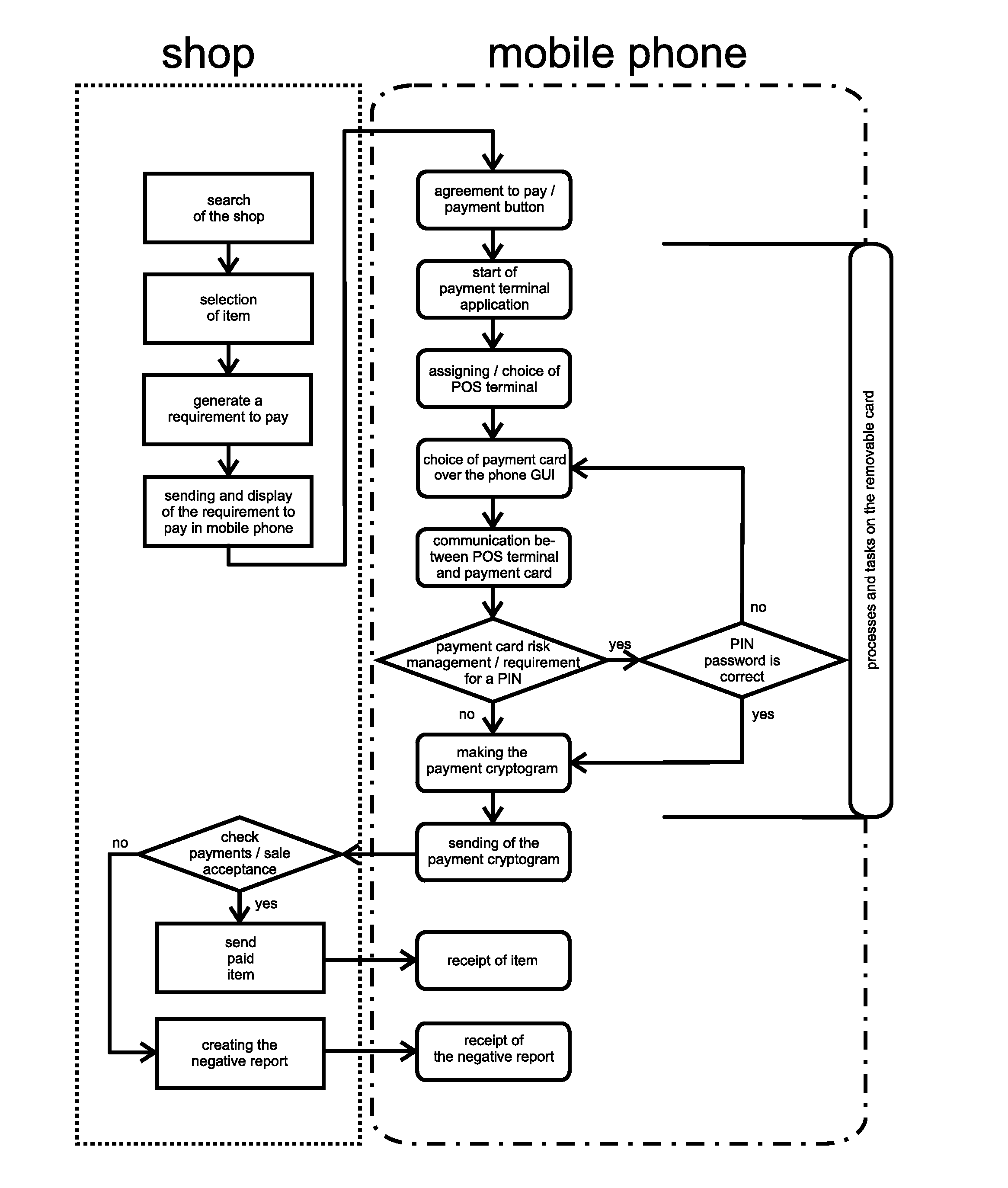

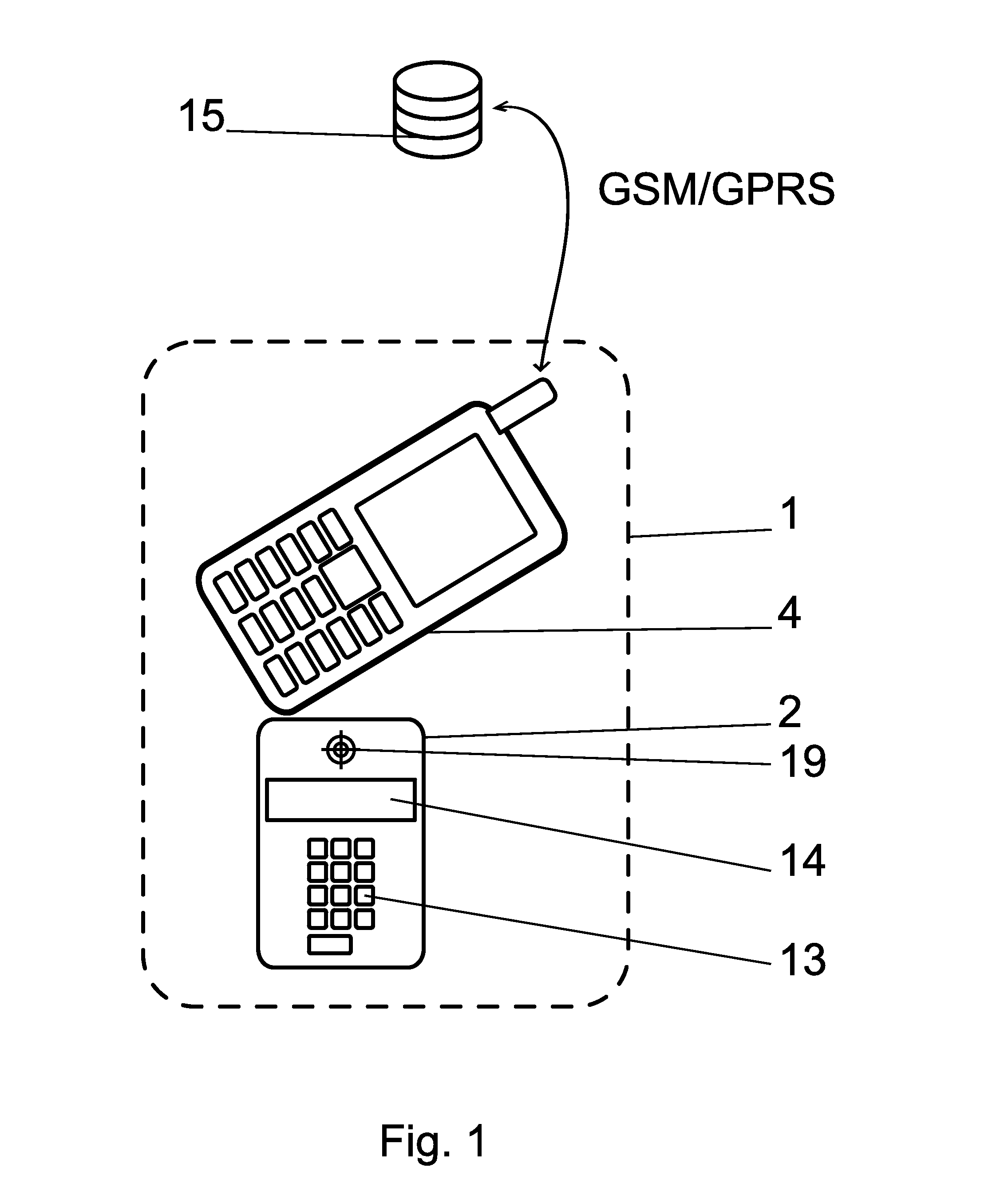

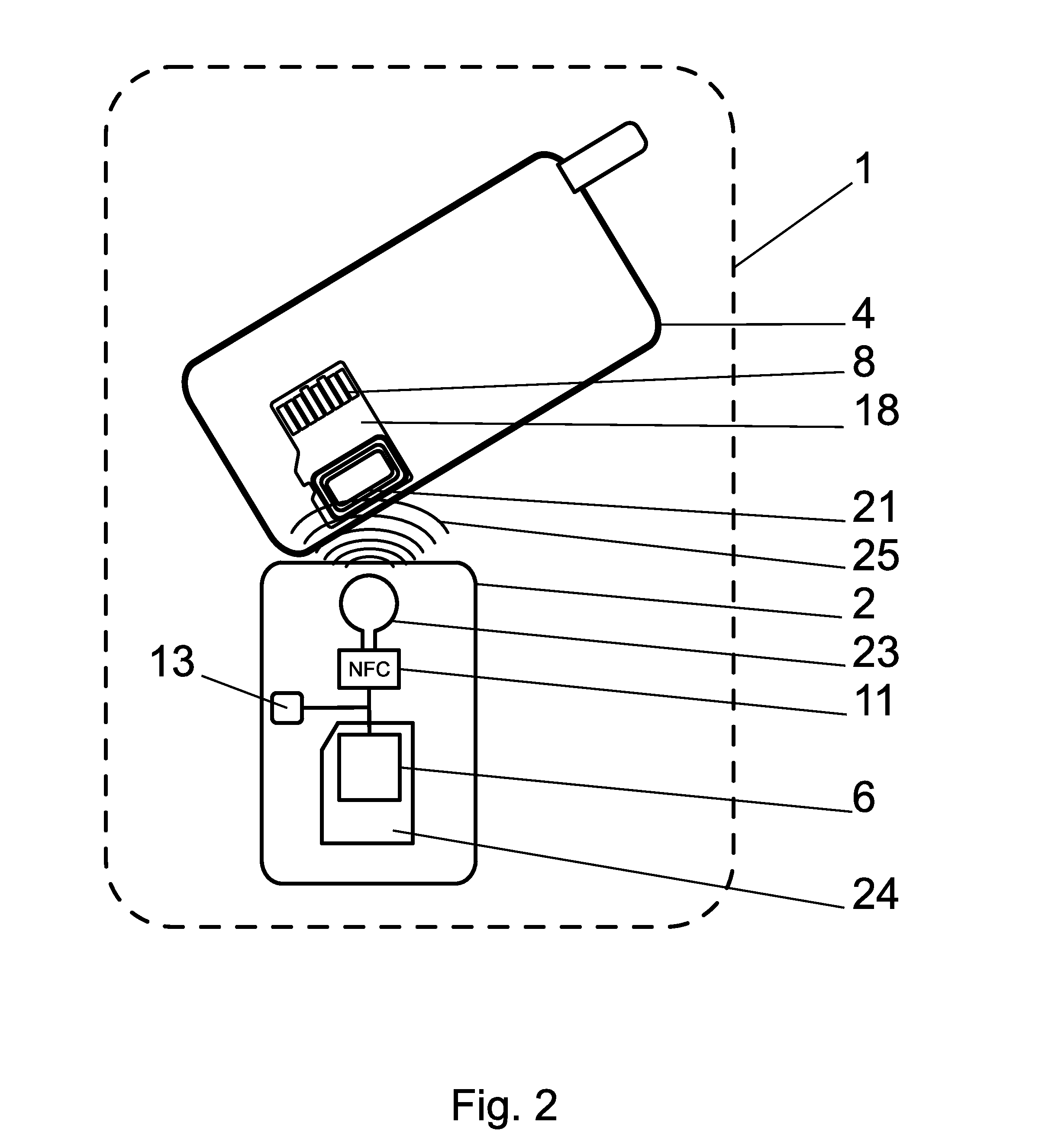

A payment terminal using a mobile communication device (4), such as a mobile phone, is located on a removable memory card (1), e.g. type microSD card, which is adjusted in such a way so it can be inserted into an additional hardware slot, e.g. memory slot. A payment POS terminal application runs on a removable memory card (1), which contains at least one payment card. The payment card's unit (7) with the card's payment application is located in the secured part of the memory, separately from the terminal's configuration data unit (6). The configuration data of the terminal's selected identity and the payment card's data are located in the separate parts of the secure element or in completely independent secure elements or they can also be localized in the Sales Device of the merchant and there e.g. within the ICC card (29) or SAM card (42).

Owner:SMK CORP

Portable near-field communication device

InactiveUS20140101056A1Preventing executionSimple and cheap solutionFinanceDevices with sensorComputer hardwareComputer terminal

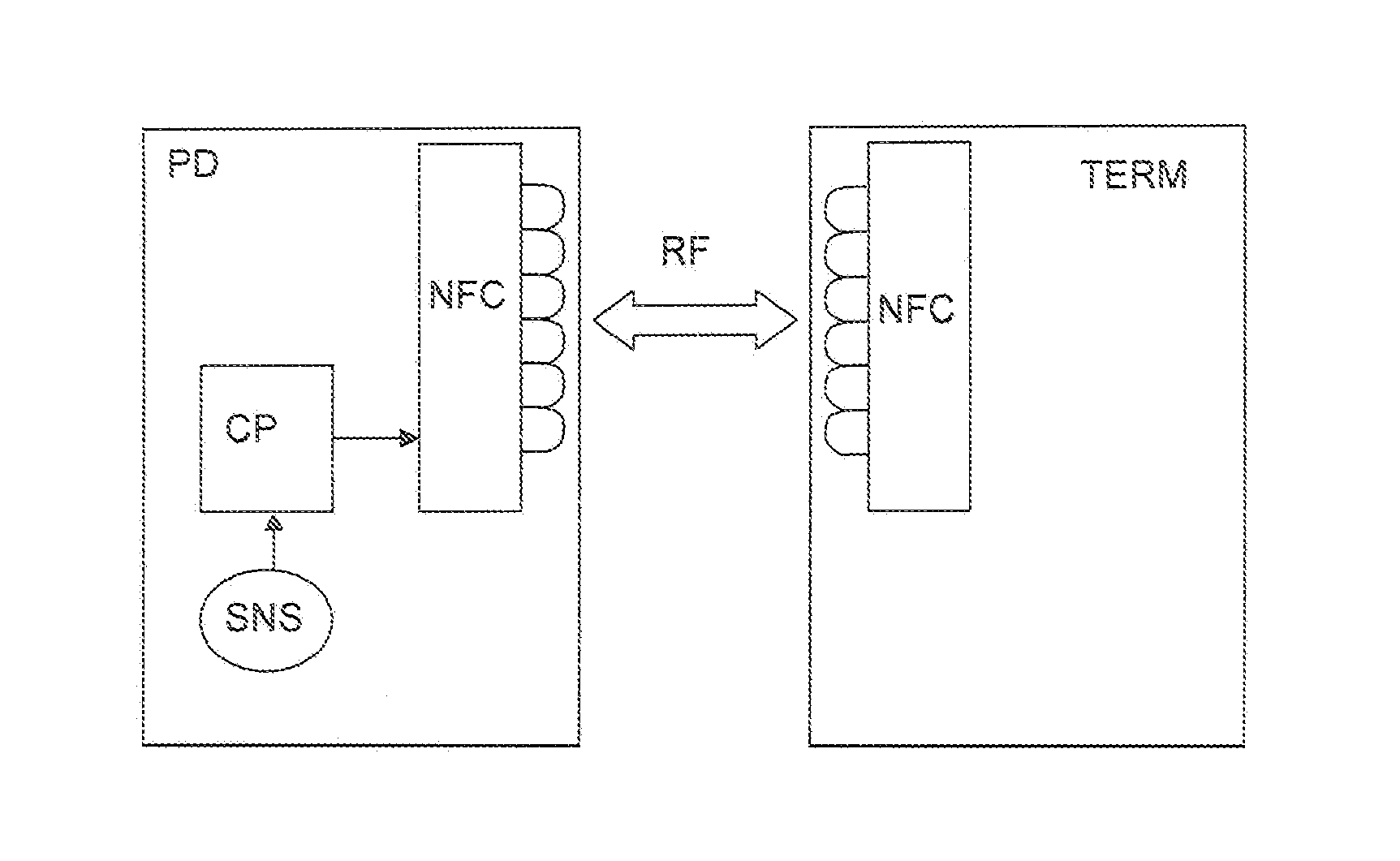

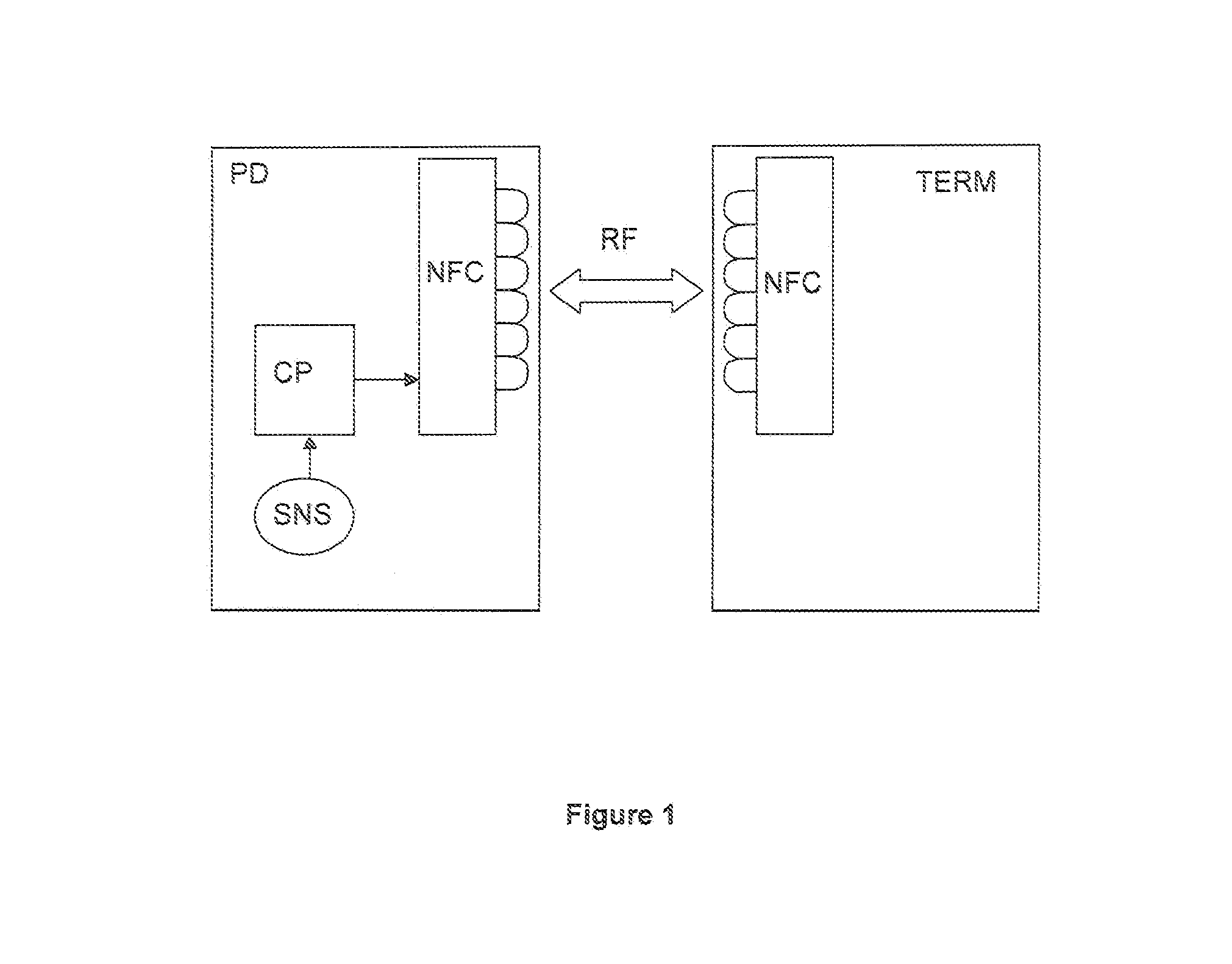

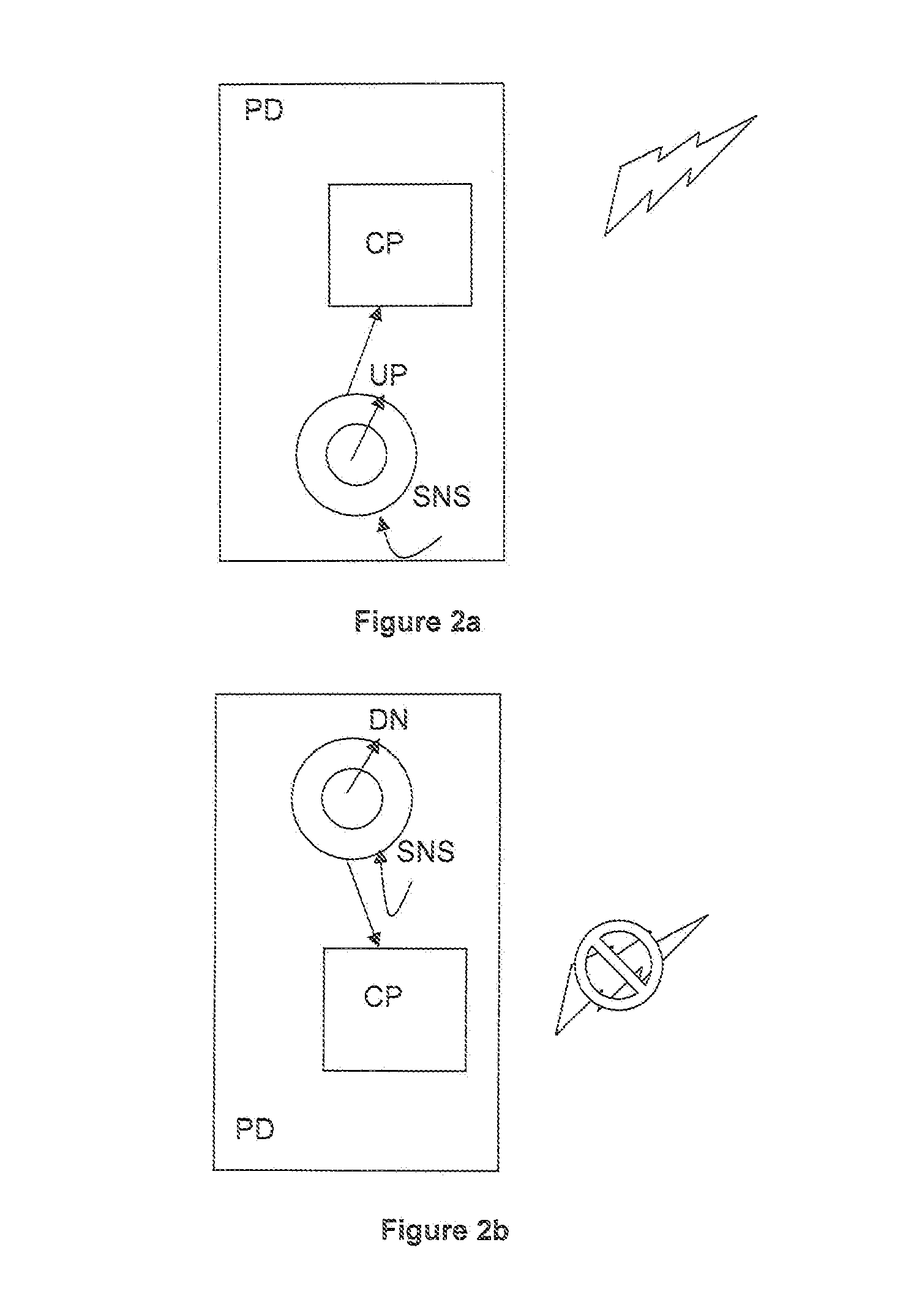

An embodiment of the present invention may be deployed in a mobile payment device configured to communicate with a payment terminal via an RF near-field communication channel. The payment device comprises a sensor to detect and log usage parameters corresponding to behaviors of the user of the payment device. Sensors may take the form of any from movement sensors, light sensors or orientation sensors for example. In order to prevent inadvertent execution of a payment instruction from the terminal, the log of parameters created due to the user's behaviors is compared with a predetermined set of parameters compatible with a user's expected behaviors should he be intentionally performing payment behaviors and payment is only authorized if a match is achieved.

Owner:NAGRAVISION SA

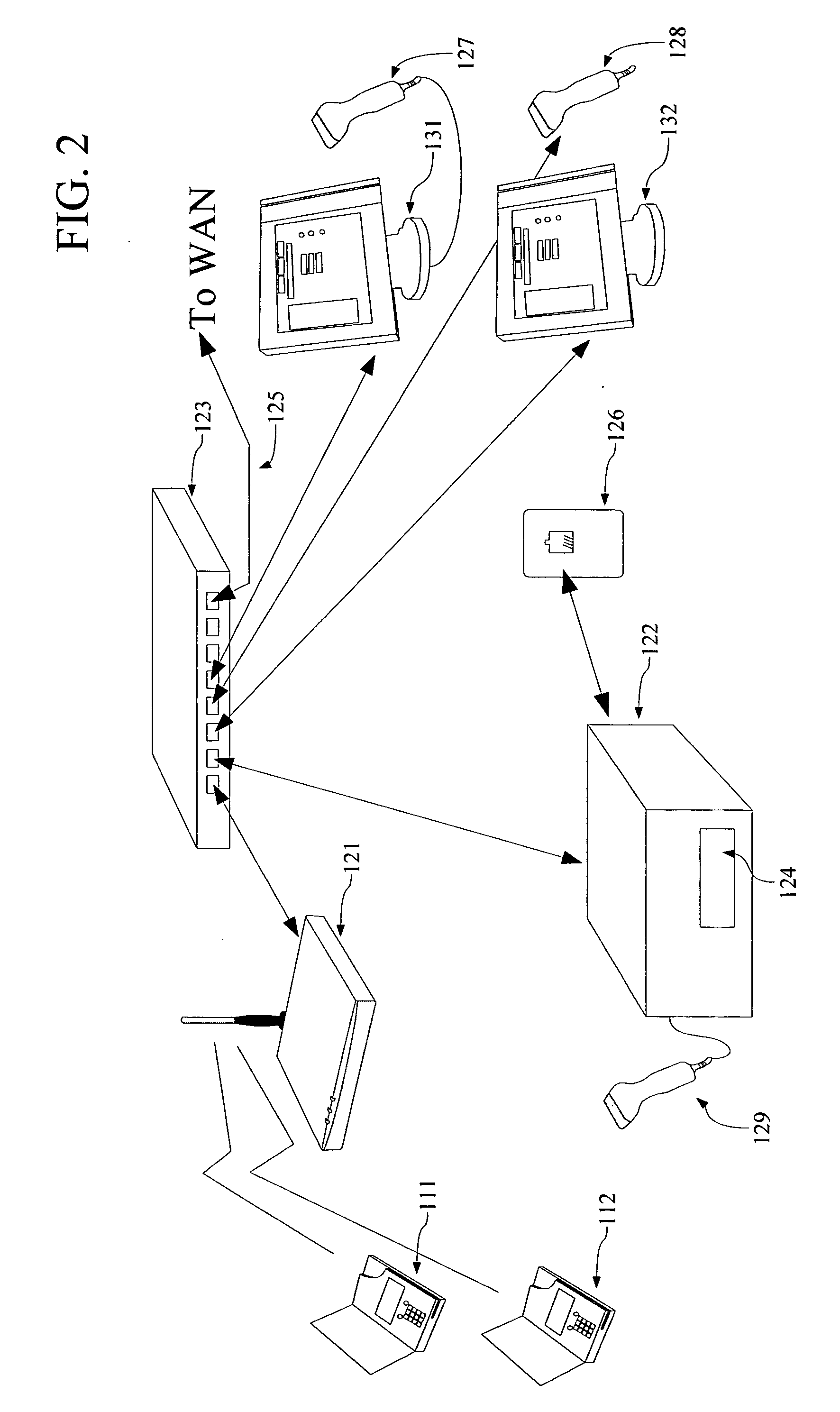

Retail checkout system and method

ActiveUS20100161434A1Reduce decreaseLow costNear-field transmissionCash registersComputer terminalTotal price

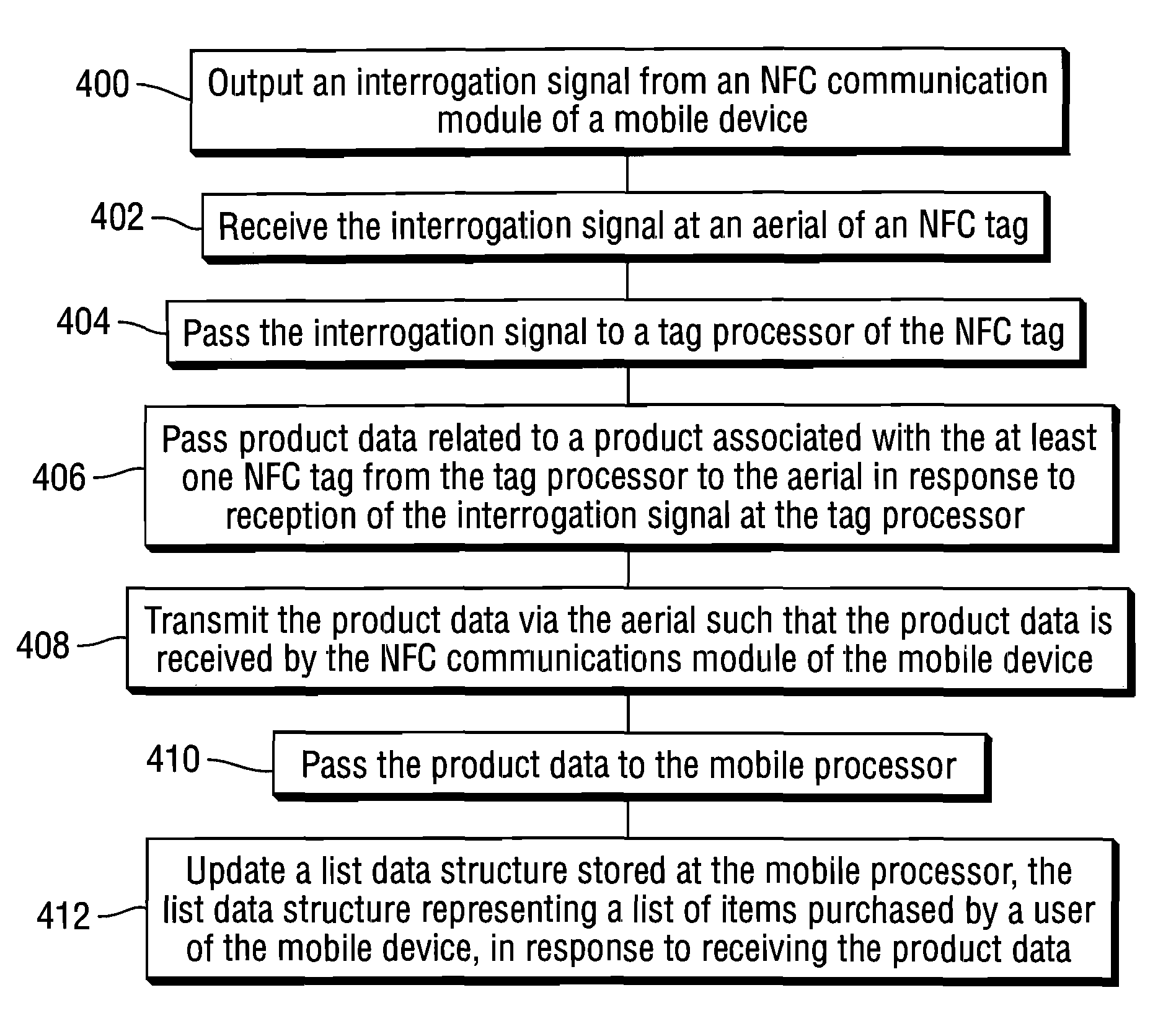

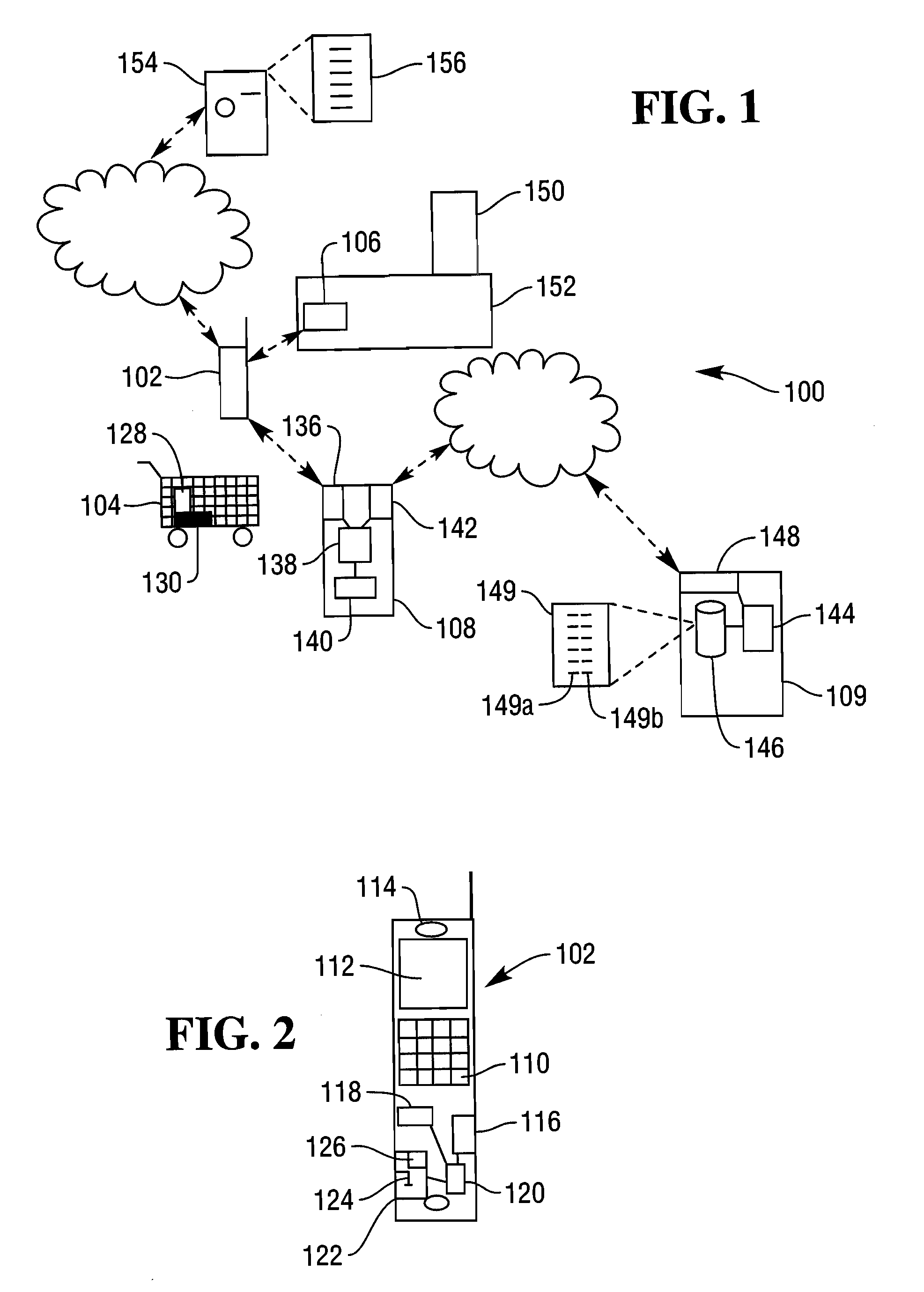

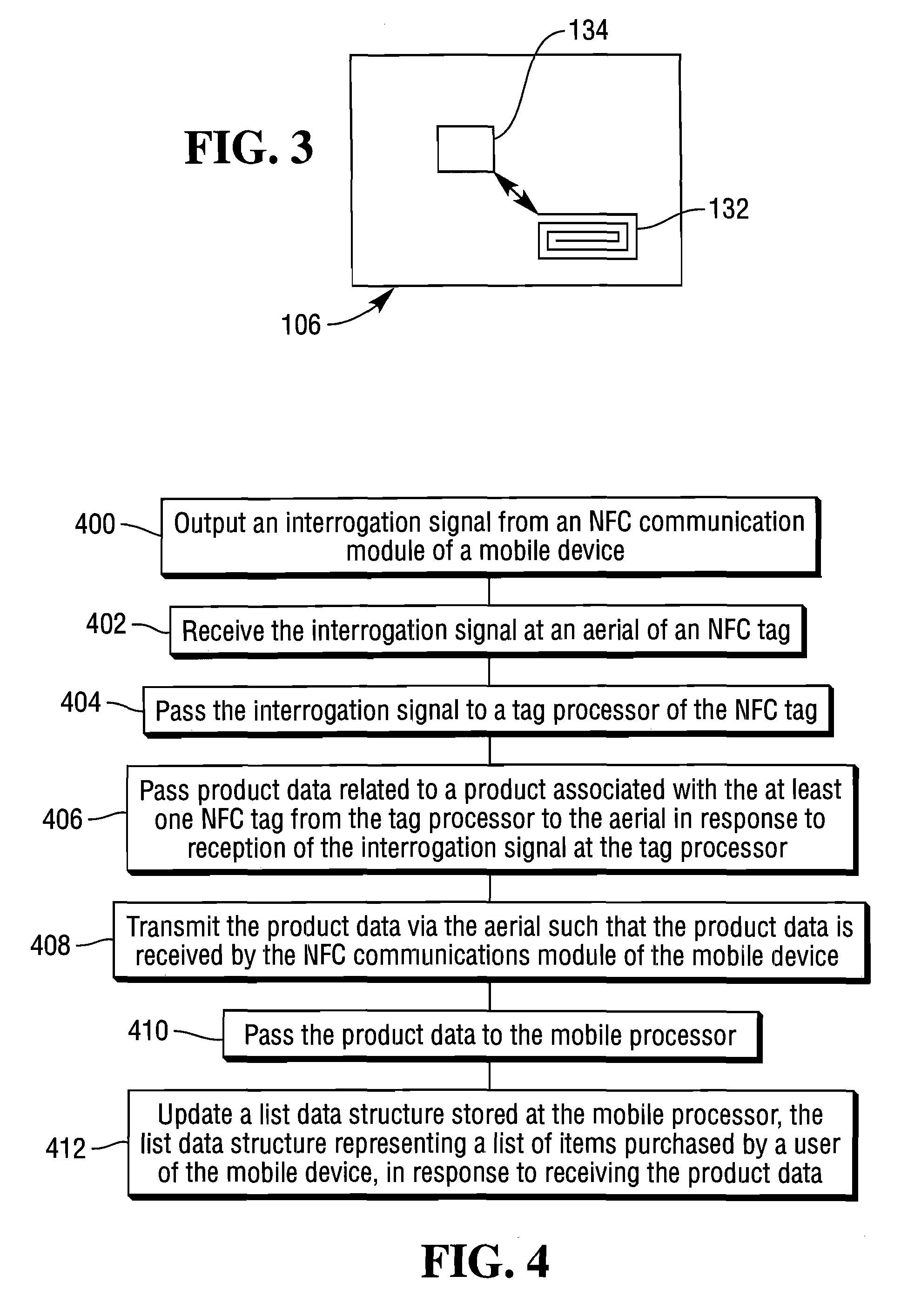

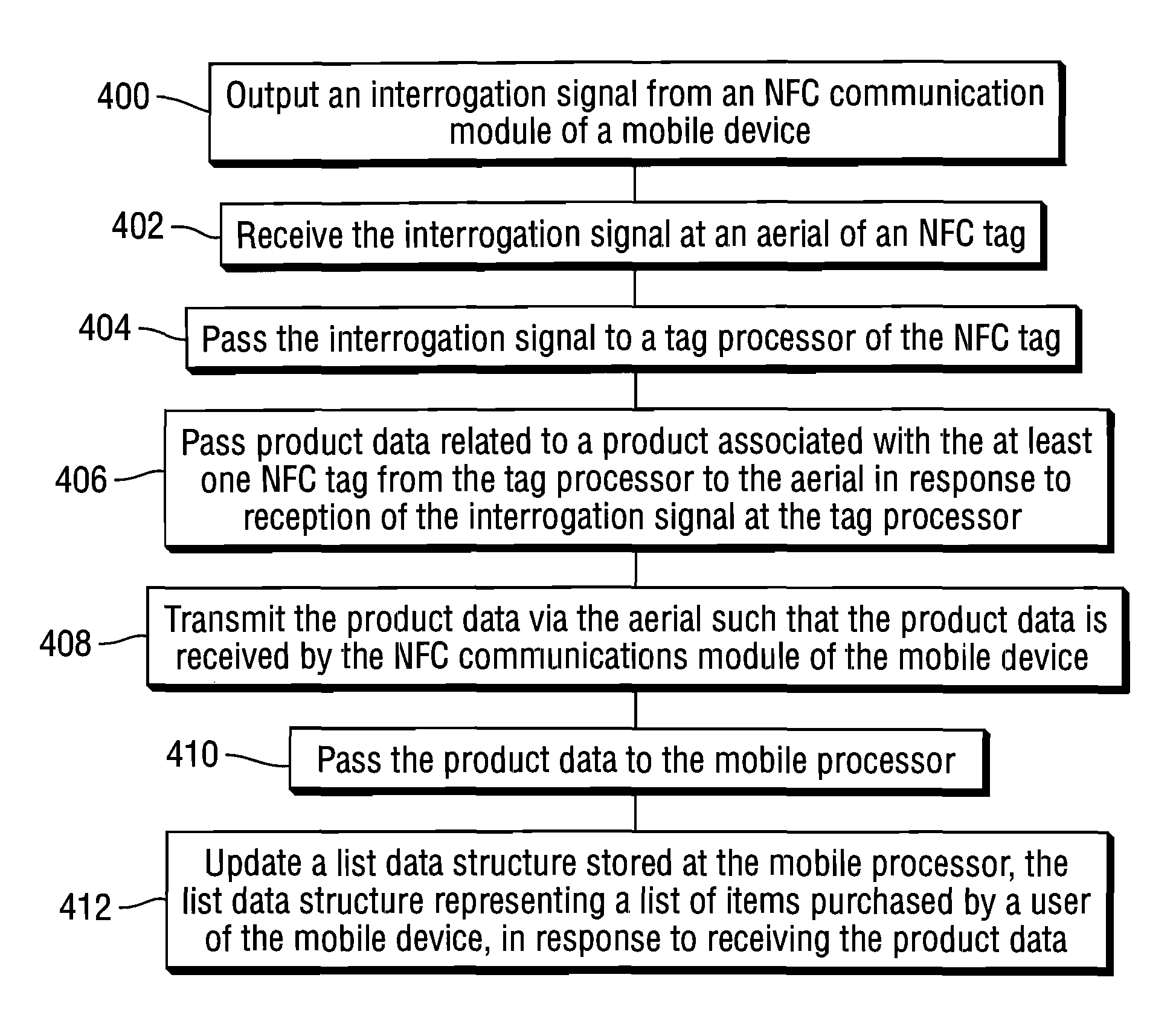

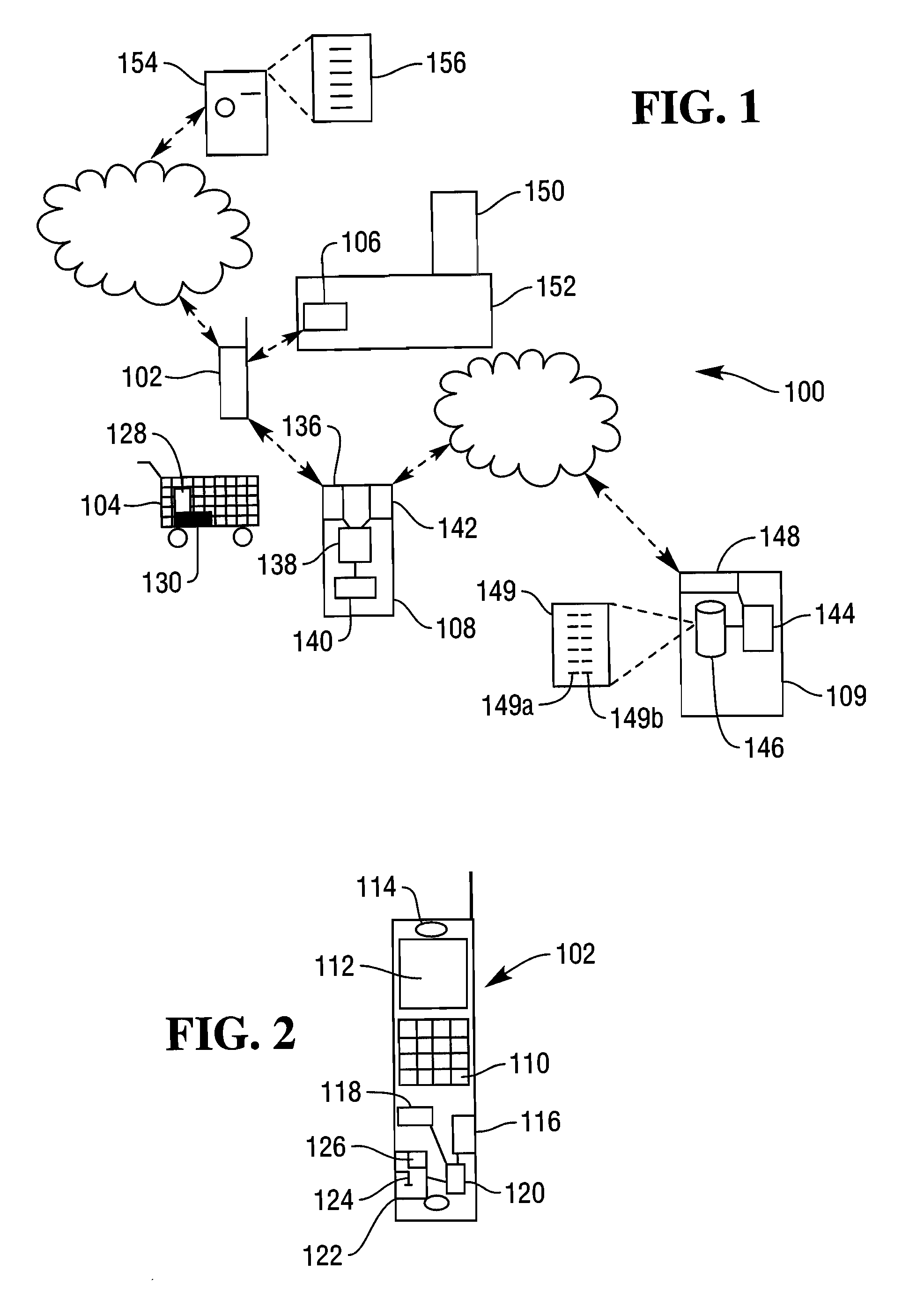

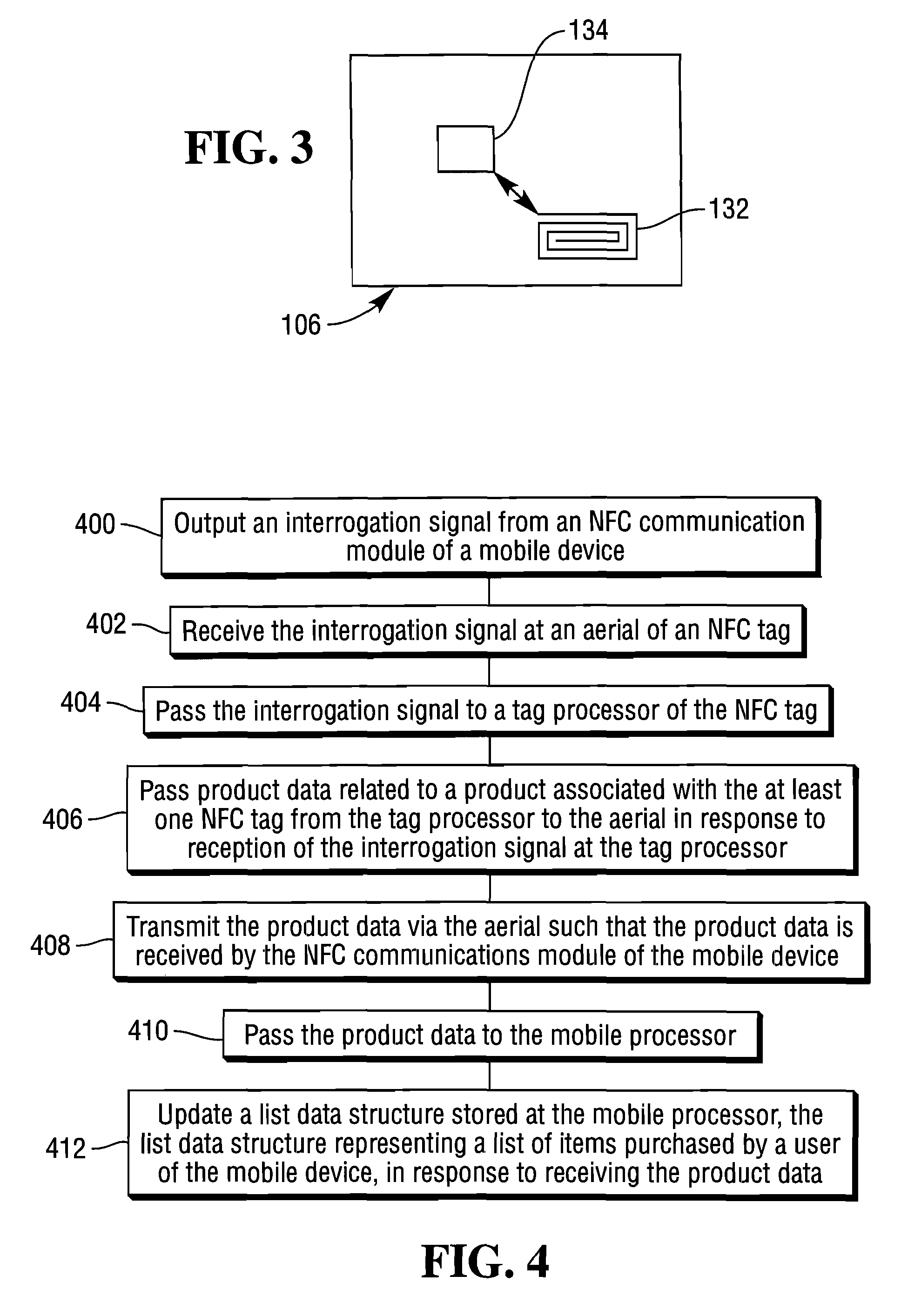

A near field communication (NFC) based checkout system comprises an NFC enabled mobile telephone that reads product data from an NFC tag associated with a product. The mobile telephone updates a shopping list when the consumer scans an item. The consumer uploads the shopping list at a payment terminal at the checkout via an NFC link. The payment terminal connects with a price look up (PLU) database and downloads the price data for the items in the shopping list to provide a total price. The payment terminal requests authorisation of the total price from the consumer's financial authorisation.

Owner:NCR CORP

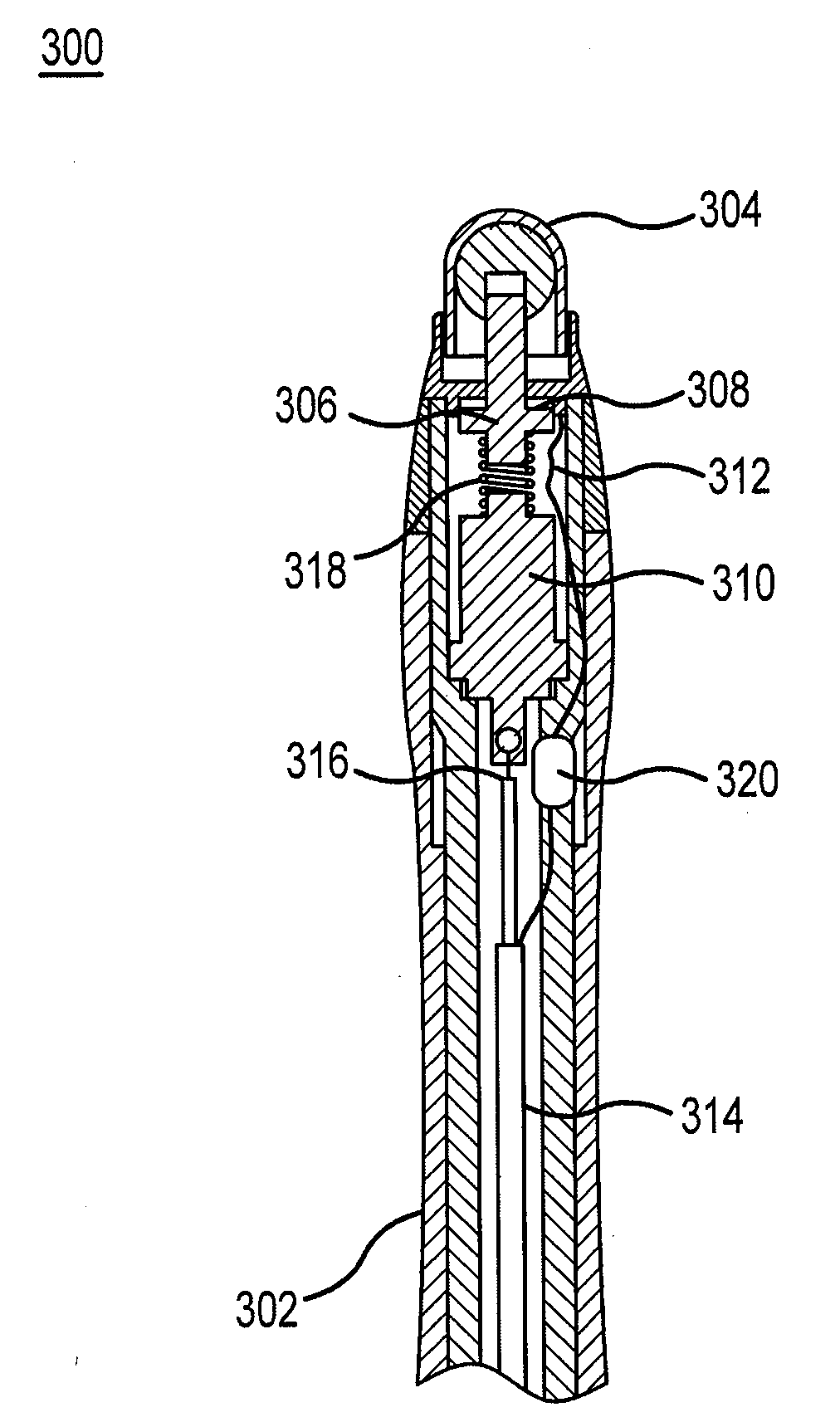

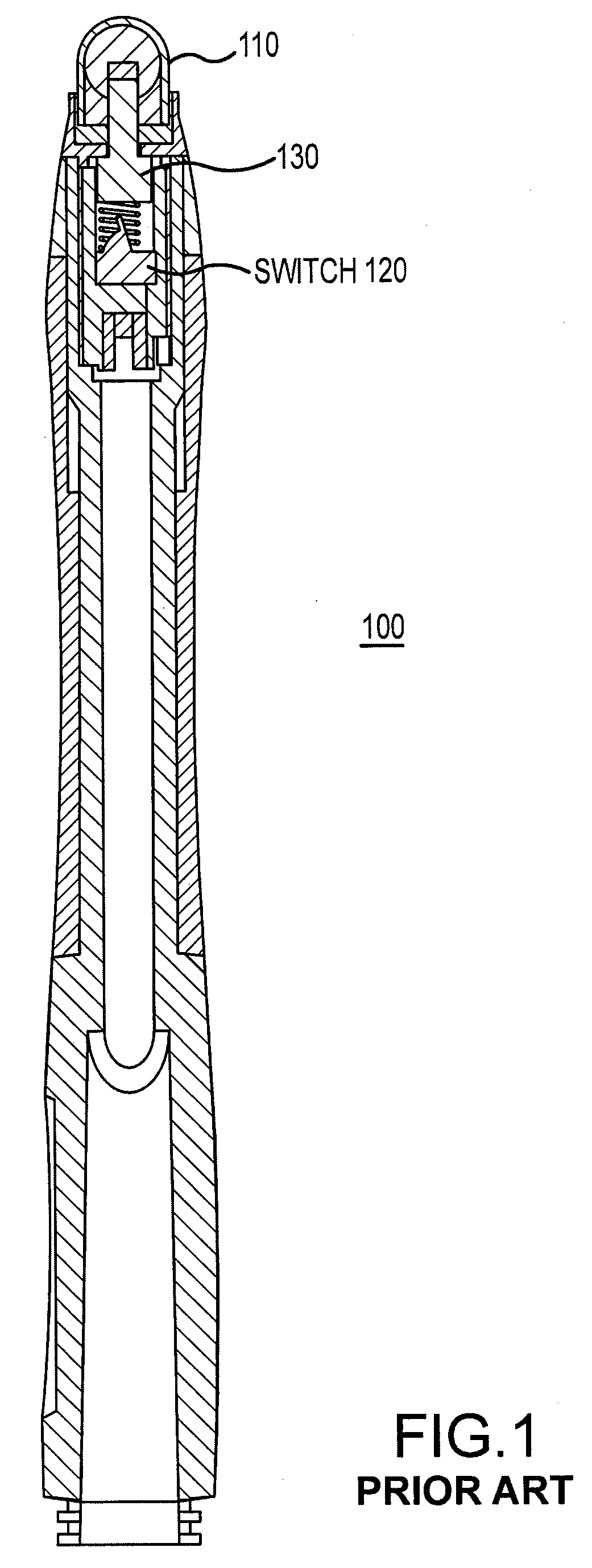

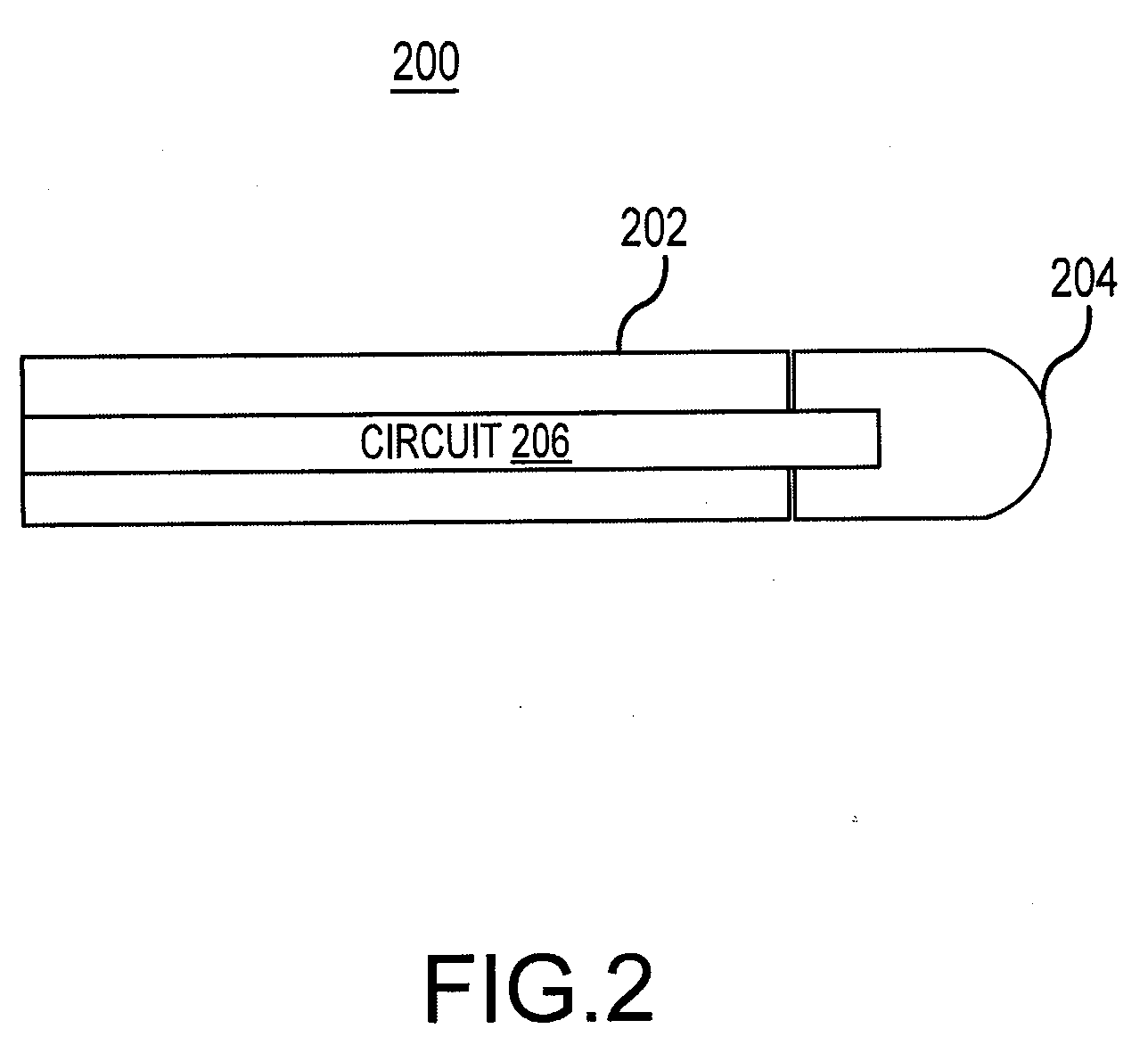

Payment terminal stylus with touch screen contact detection

ActiveUS20090289922A1Input/output processes for data processingUltrasound attenuationPhysical separation

In an exemplary embodiment, a stylus operates with a capacitive touch screen only when the stylus tip is in contact with the touch screen. The stylus is used as a sensor to determine the location where a user is touching the surface of a capacitive touch screen, but is not active until the stylus tip is pressed against the touch screen. In an exemplary embodiment, pressing the stylus tip against the touch screen activates the stylus by creating a physical separation in the circuit and disconnecting the stylus tip from ground. When the stylus tip is no longer grounded, it becomes active and is able to operate with a capacitive touch screen. In an exemplary embodiment, signal attenuation may be performed by diverting the sense signal to ground via a capacitor or other electronic component.

Owner:HYPERCOM CORP

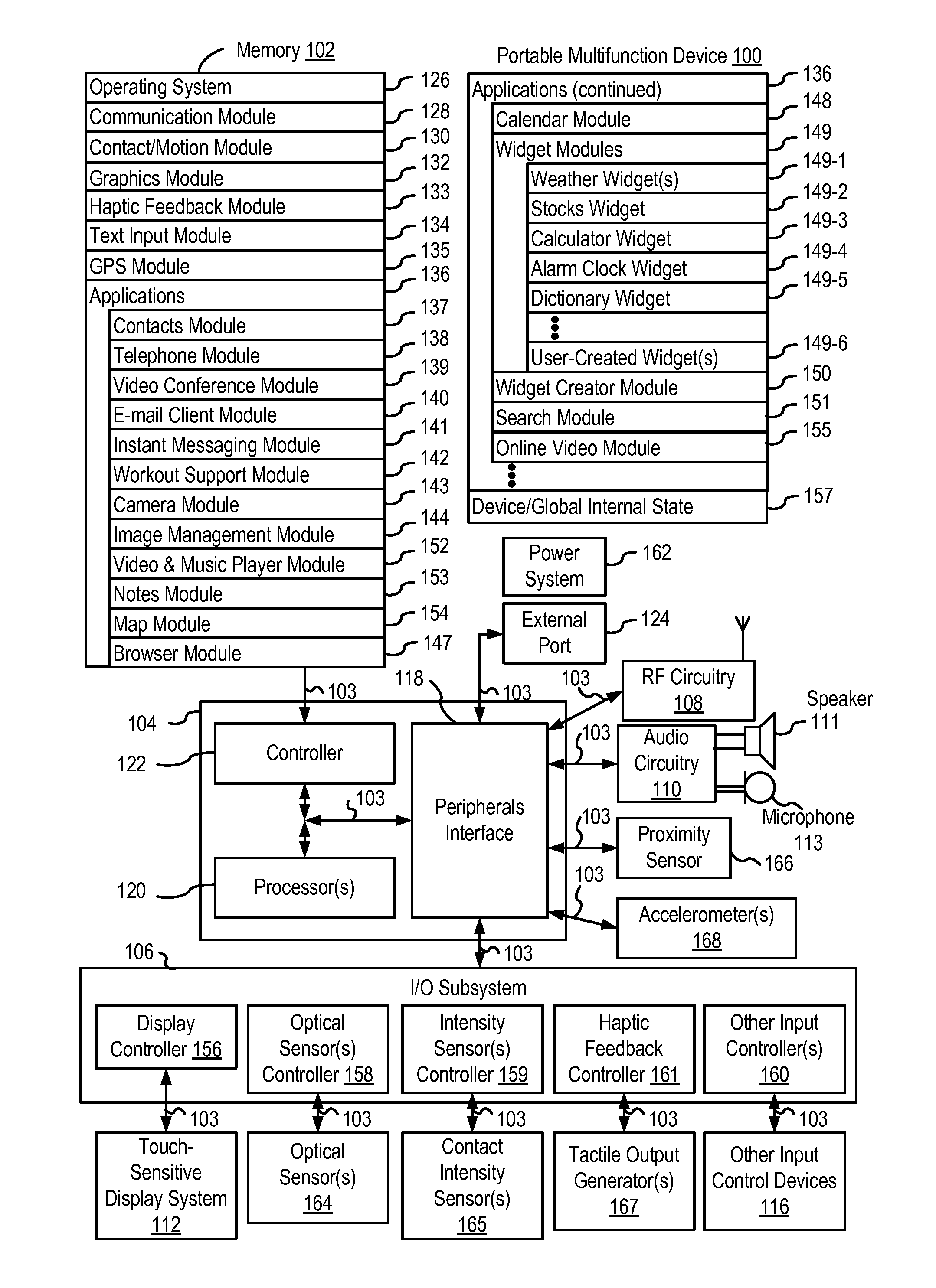

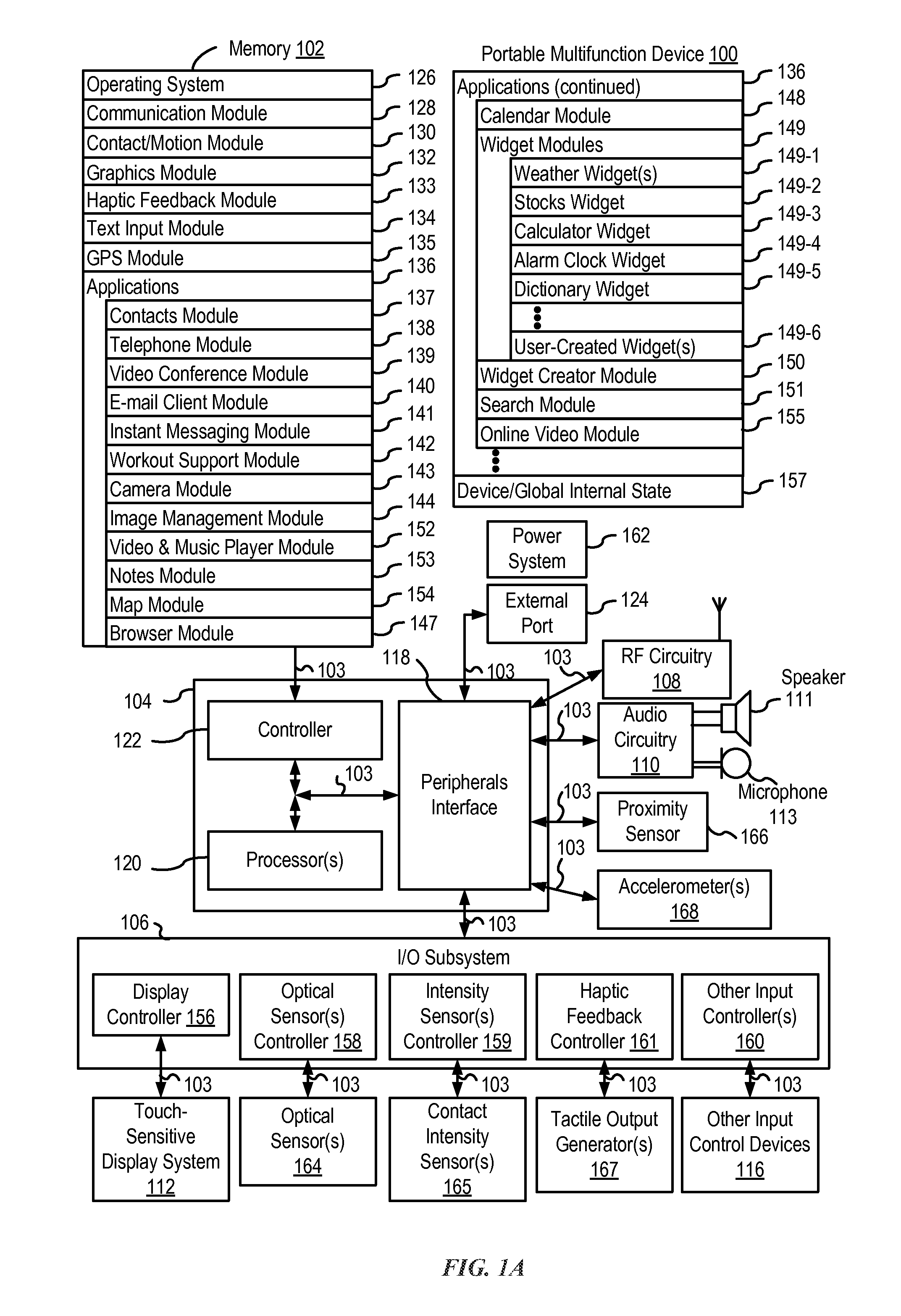

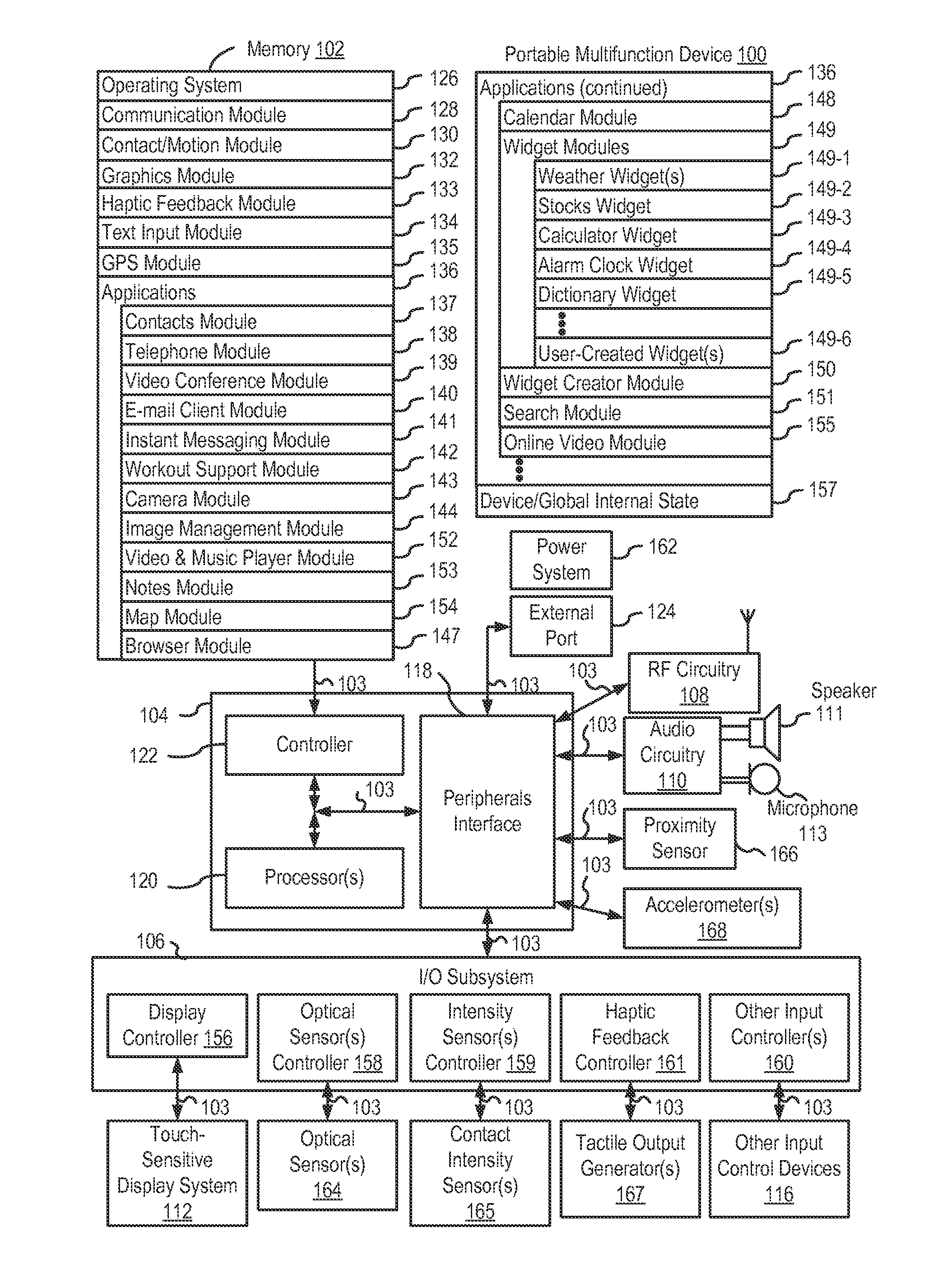

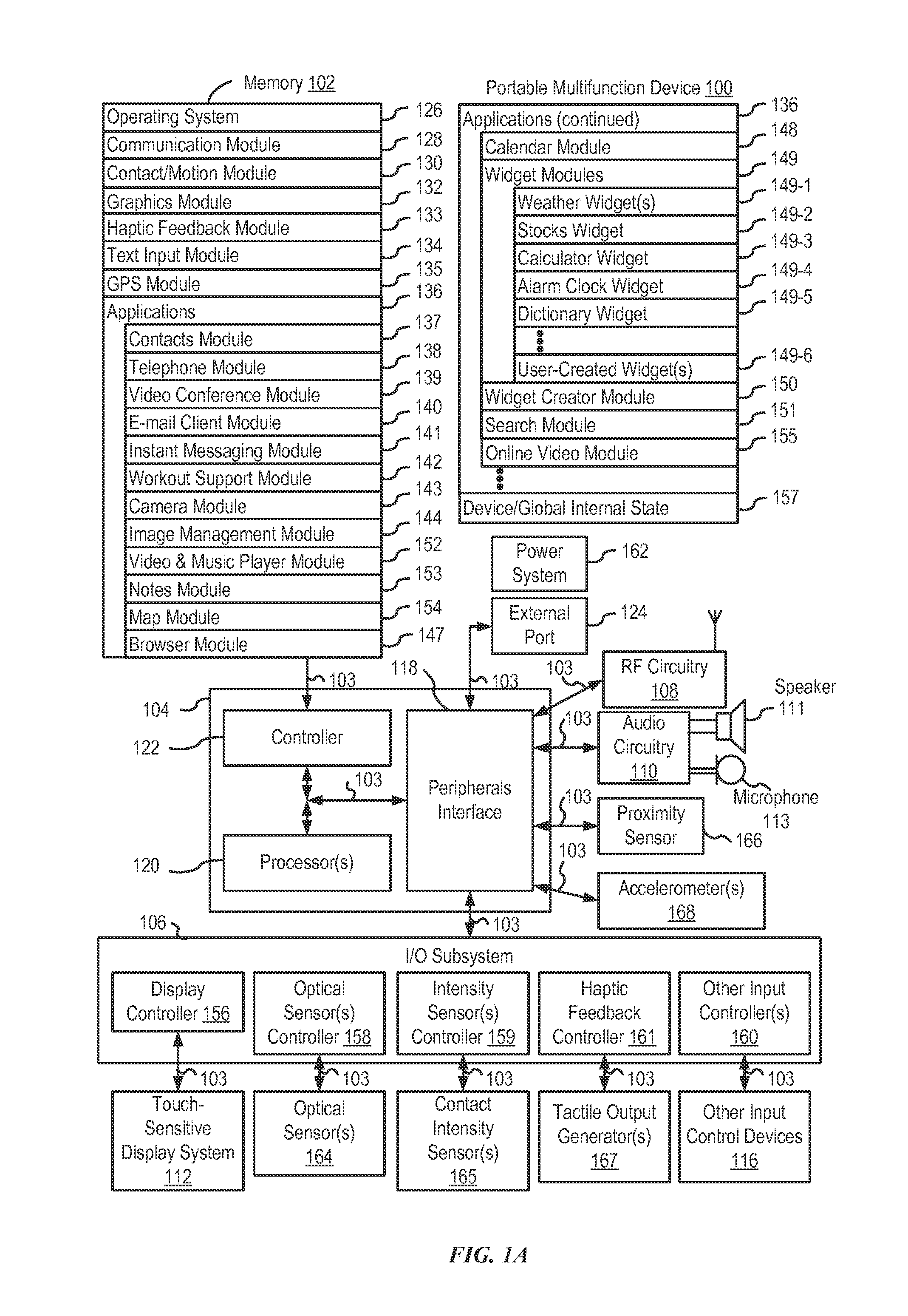

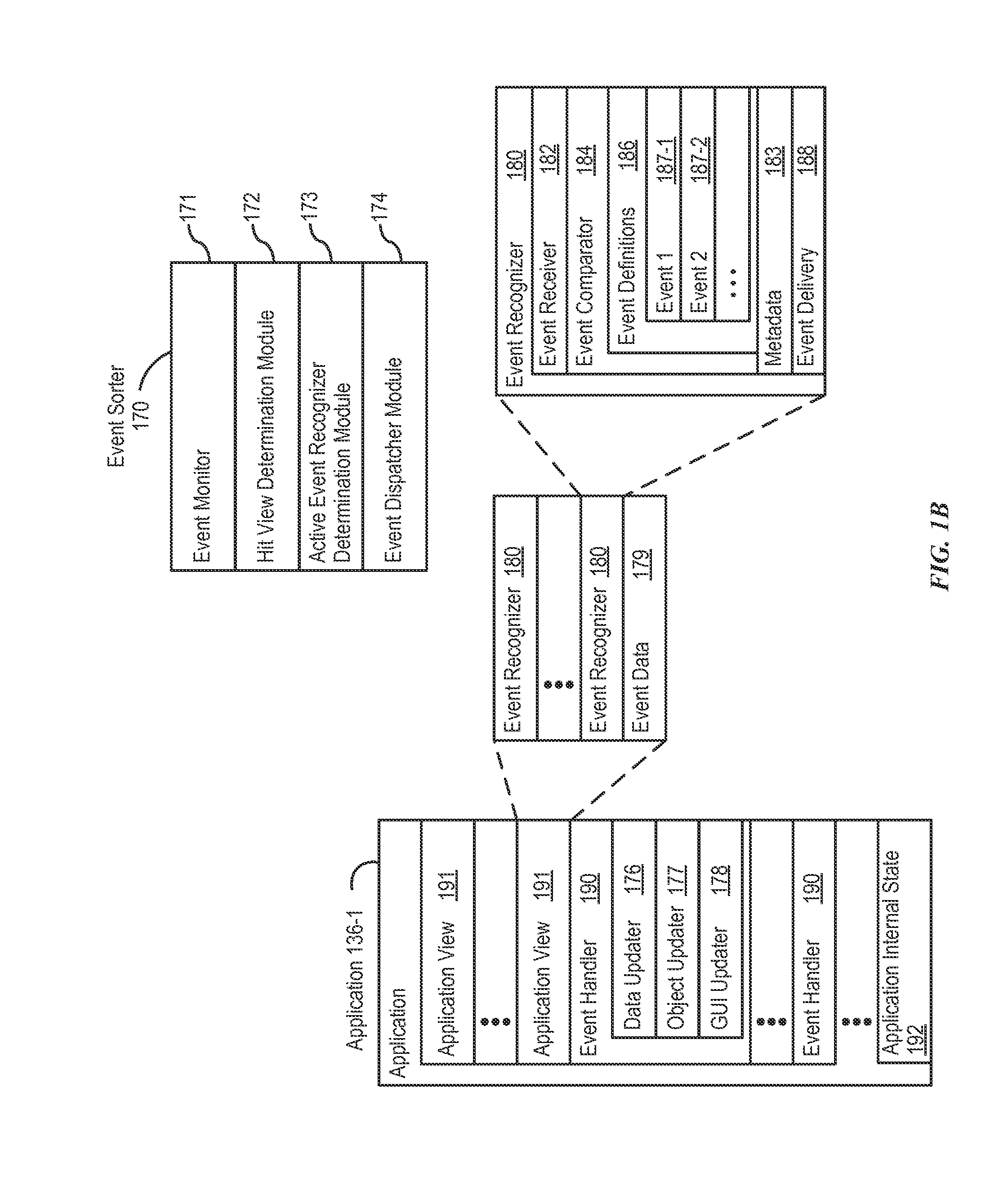

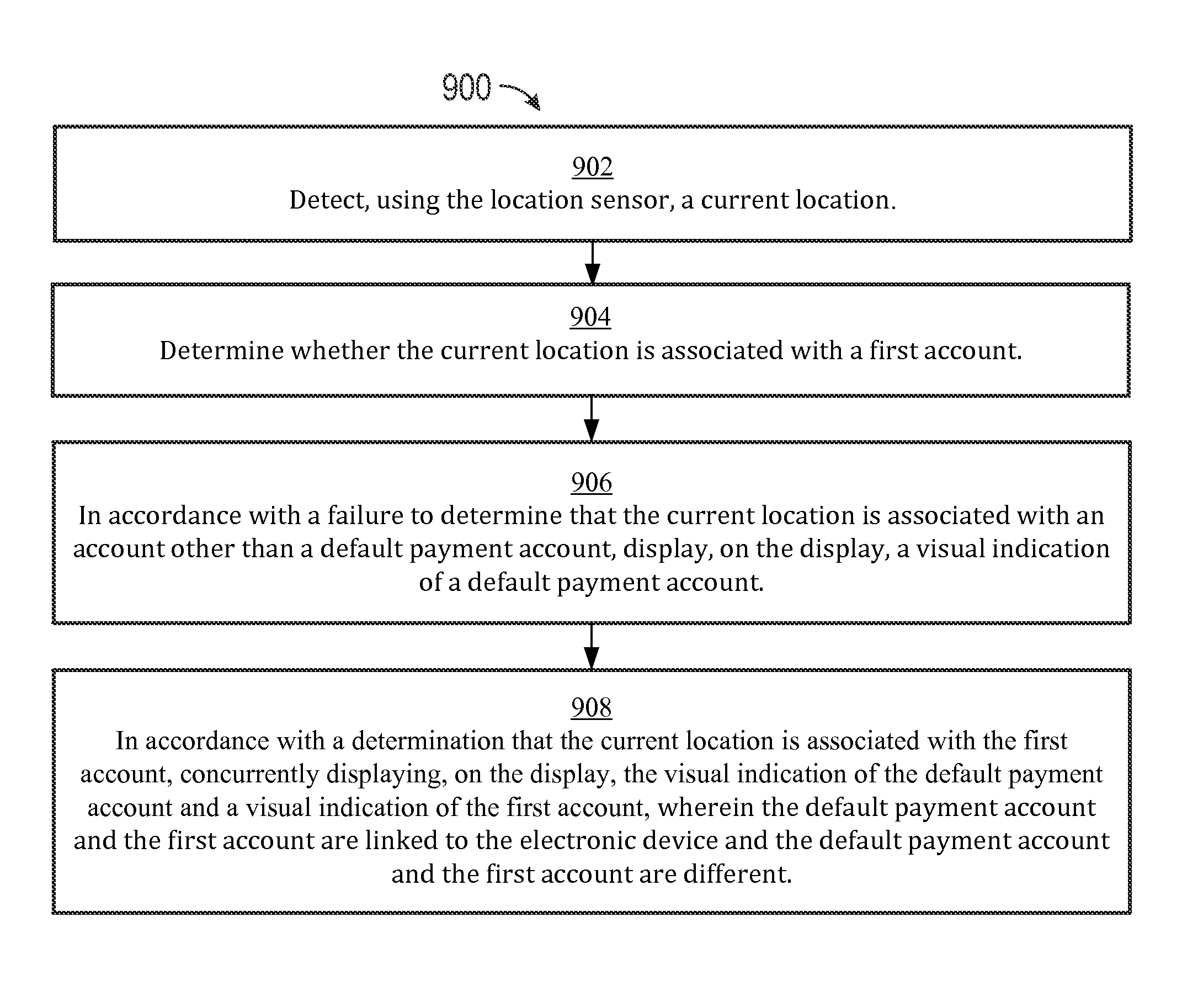

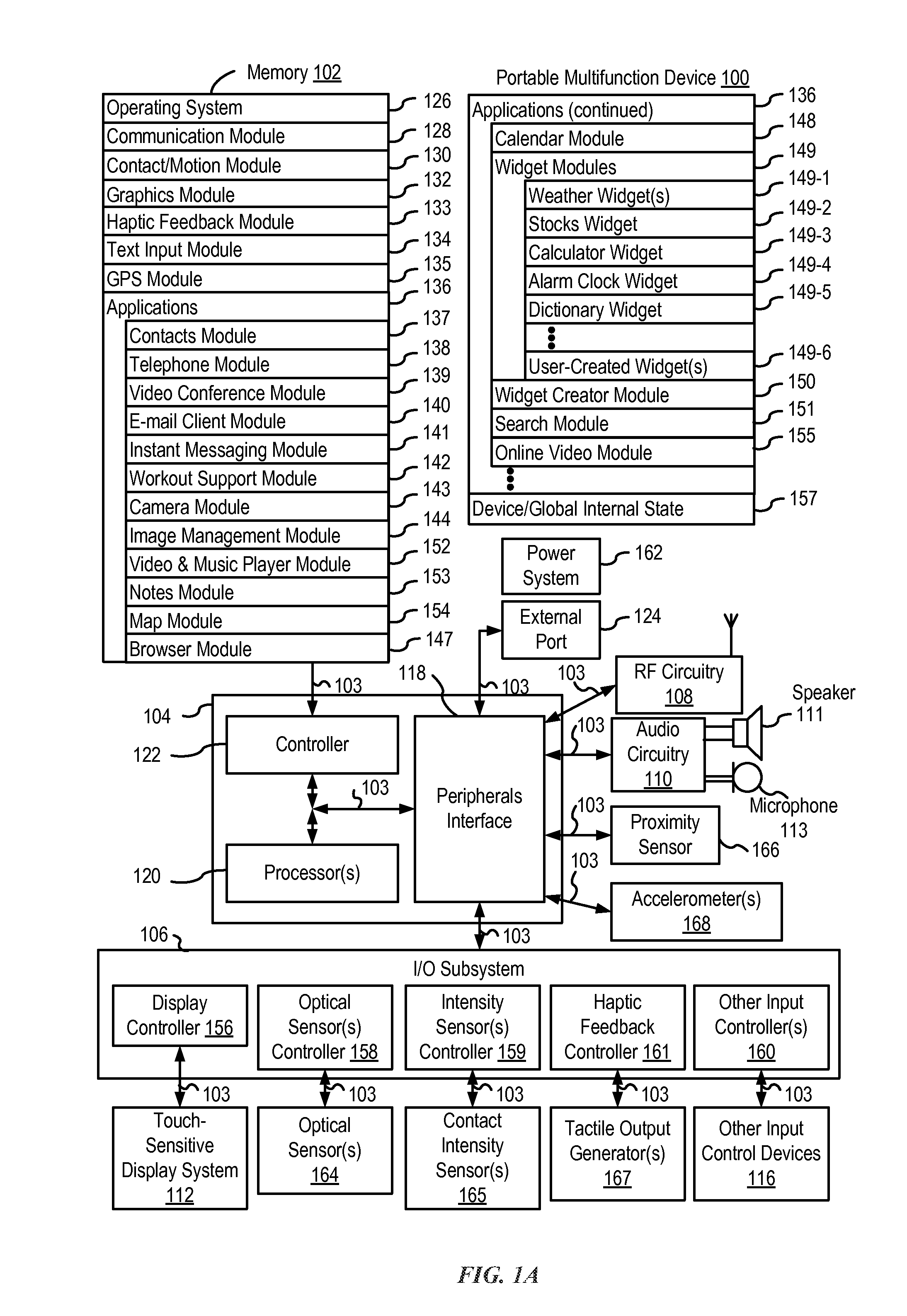

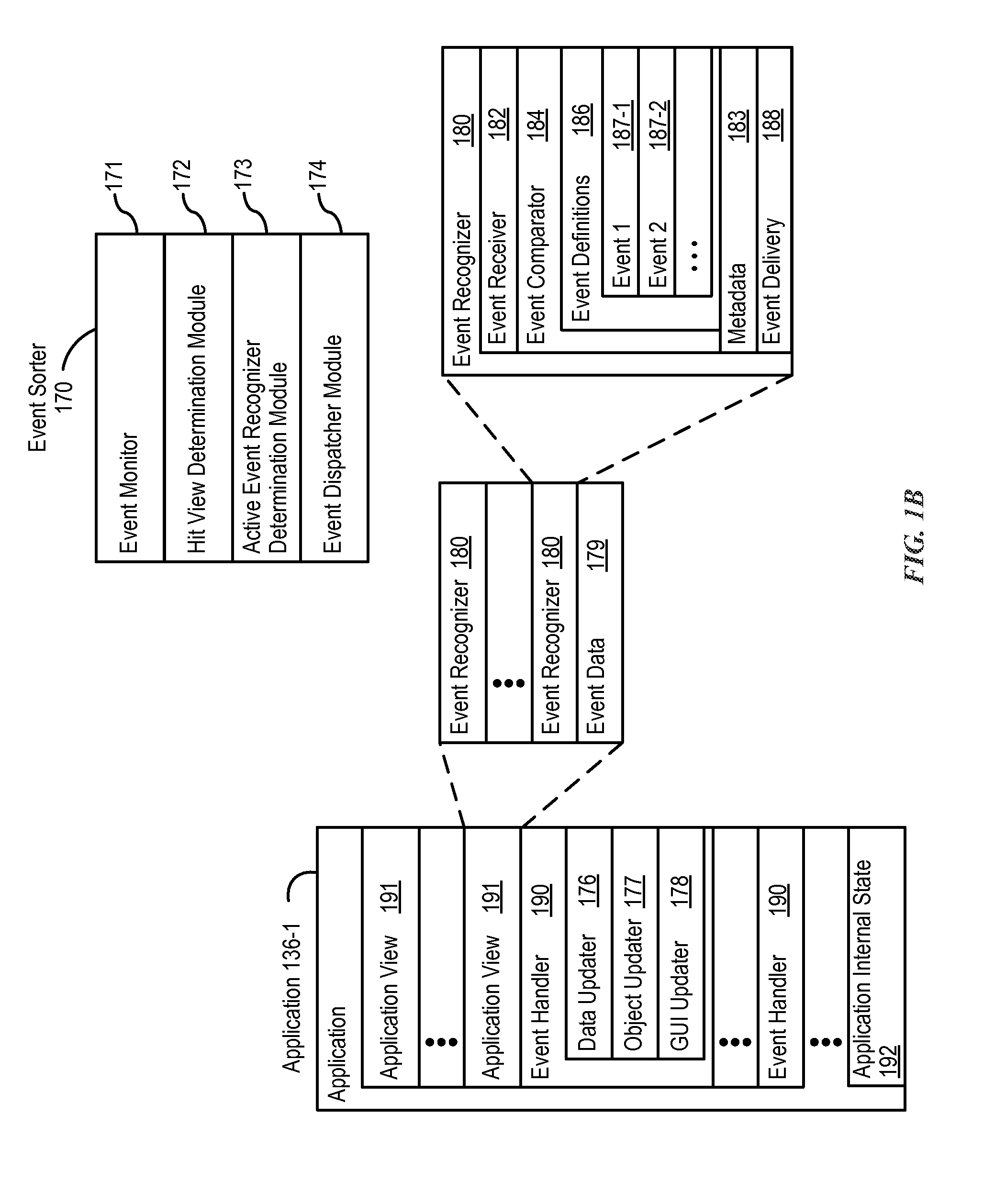

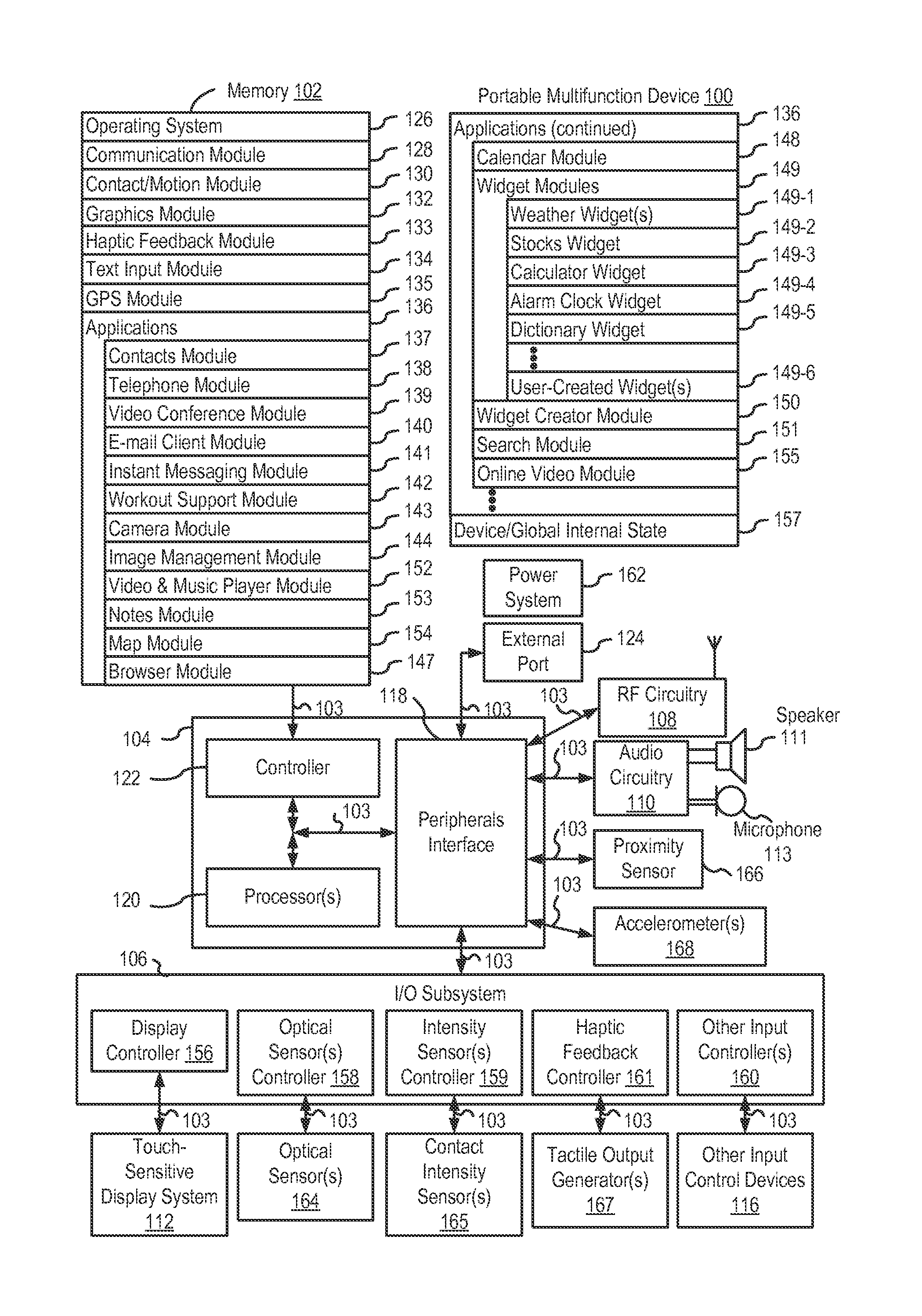

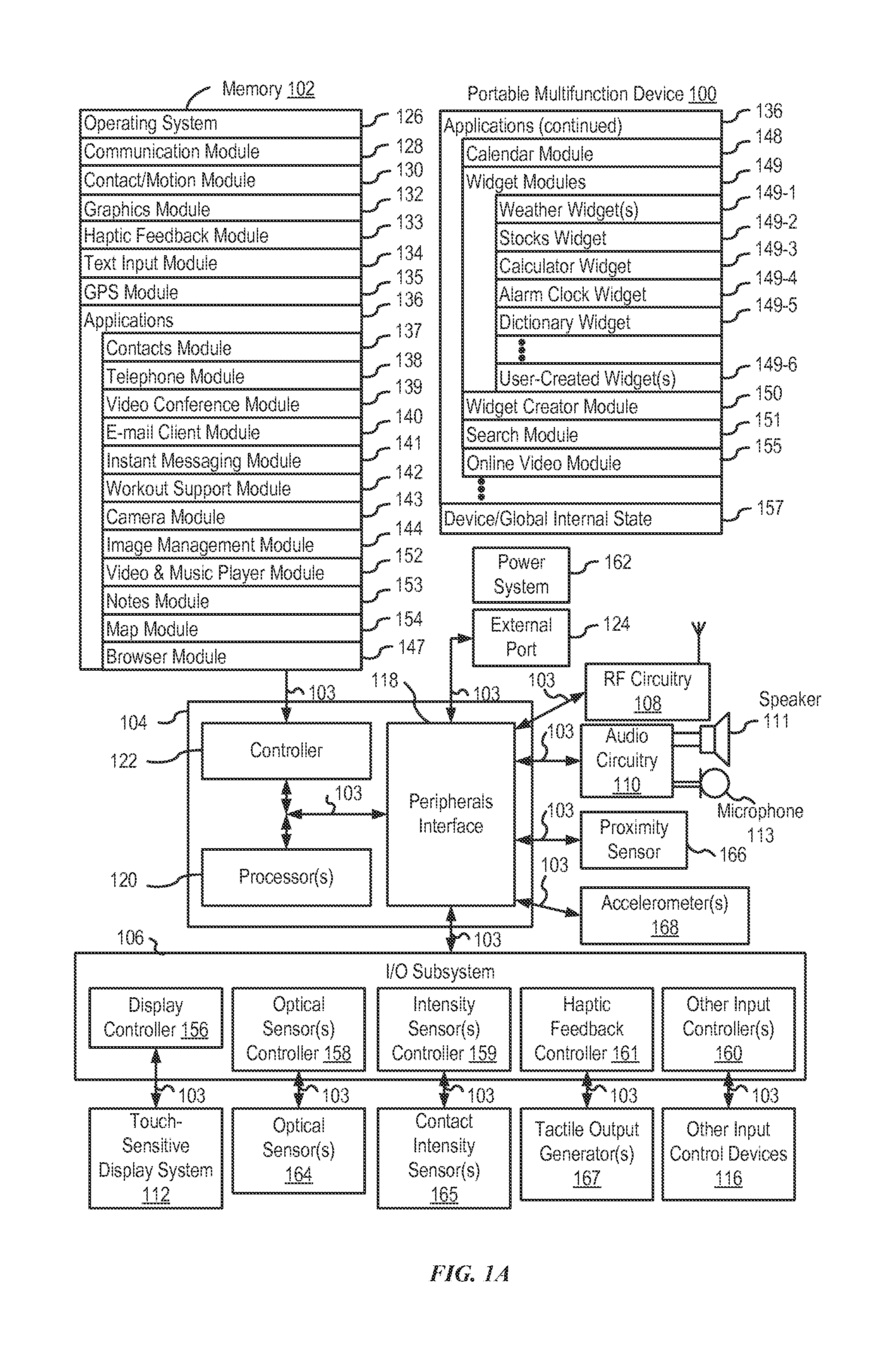

User interface for loyalty accounts and private label accounts for a wearable device

ActiveUS20160358180A1Improve effectivenessImprove efficiencyApparatus for meter-controlled dispensingPoint-of-sale network systemsHuman–computer interactionWearable Electronic Device

The present disclosure generally relates to the use of loyalty accounts, private label payment accounts, and general payment accounts using a wearable electronic device with an electronic wallet. Various accounts are linked to the electronic device. In some examples, the electronic device is NFC-enabled. The electronic device may be used to provide loyalty account information and payment account information to a payment terminal, such as an NFC-enabled payment terminal.

Owner:APPLE INC

Retail checkout system and method

ActiveUS8494908B2Low costReduce maintenanceNear-field transmissionCash registersTotal priceAuthorization

Owner:NCR CORP

Secure Payment Terminal

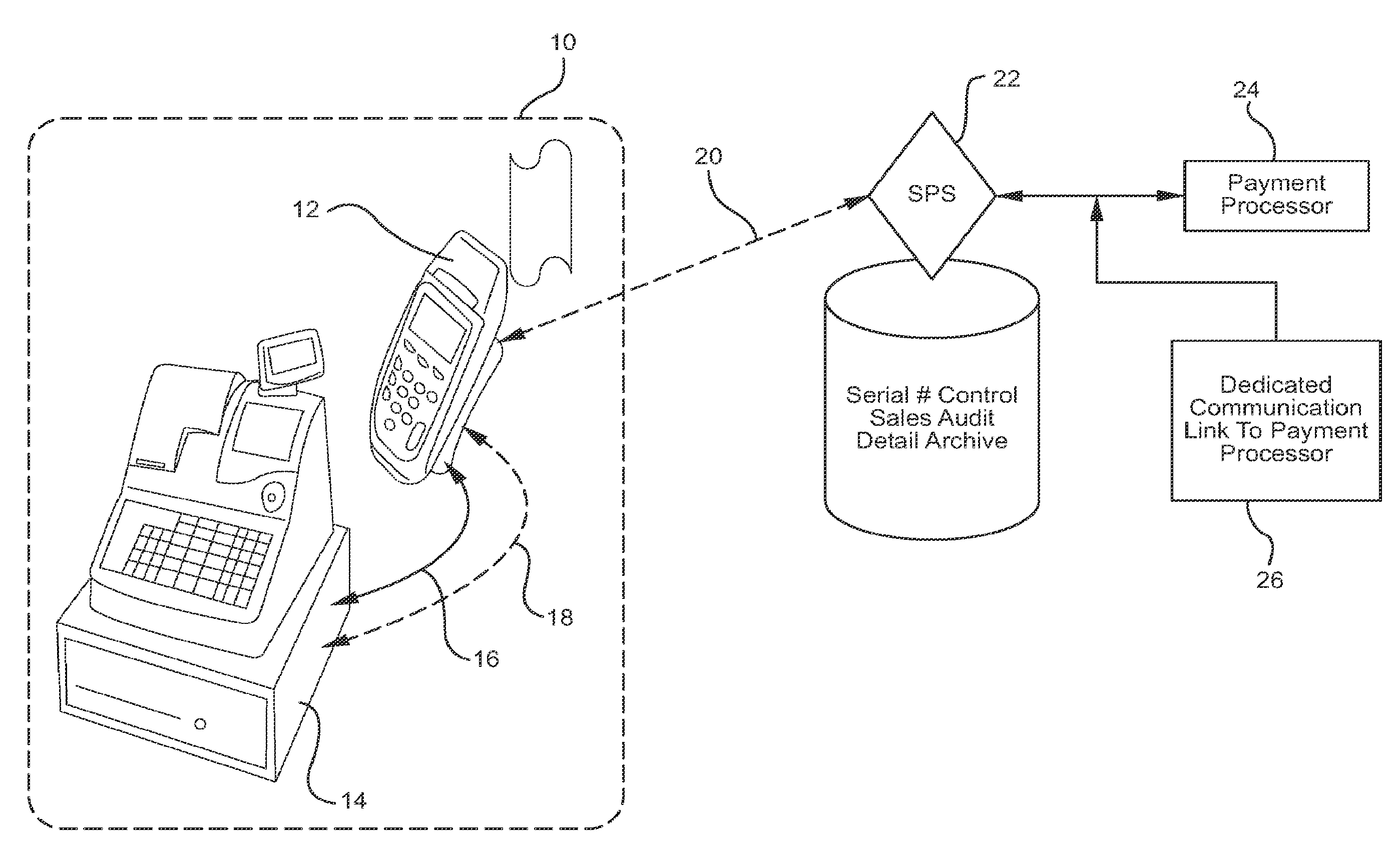

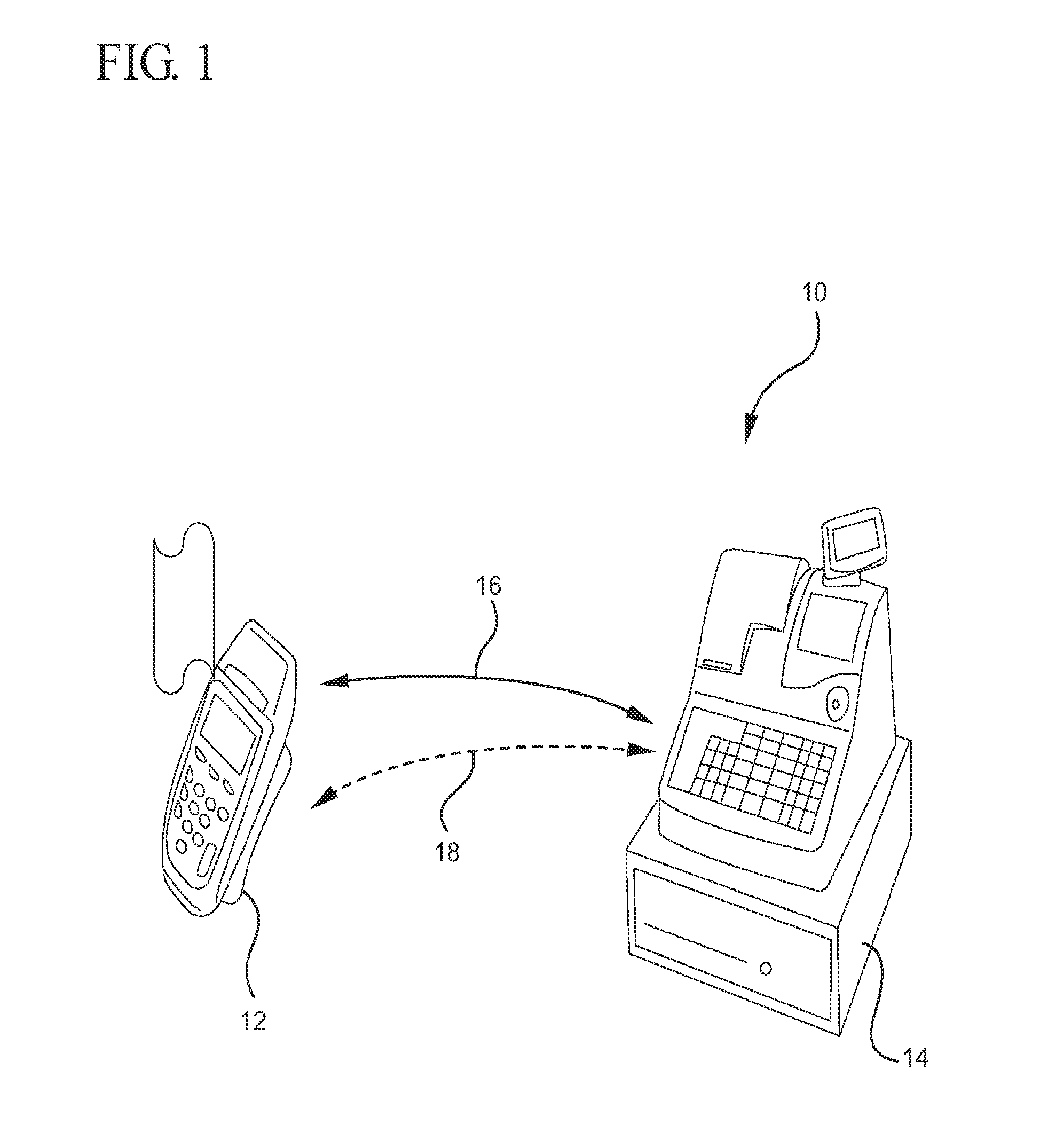

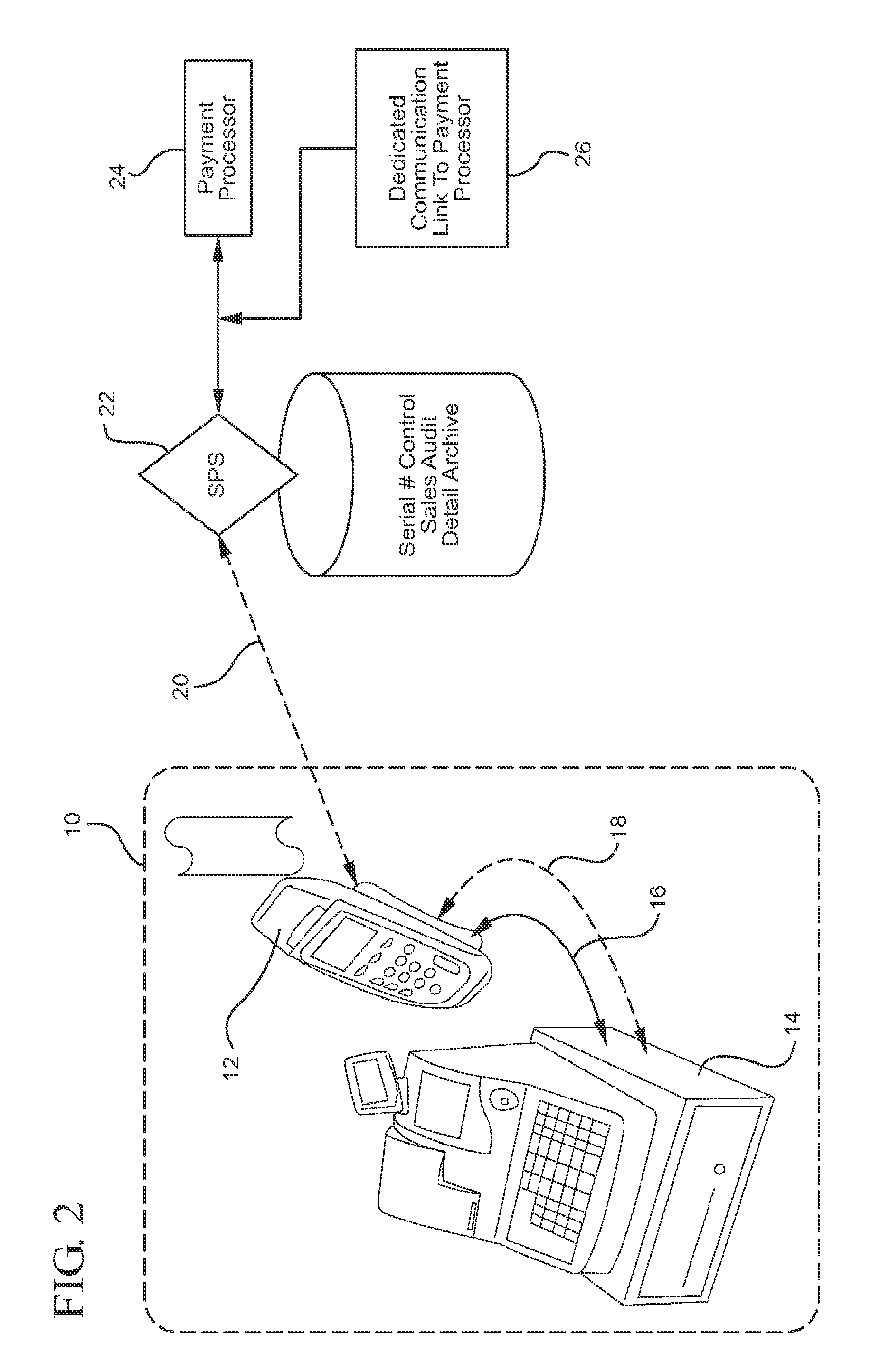

InactiveUS20120290420A1Eliminate needFunction increaseAcutation objectsCash registersAuthorizationDatabase

Exemplary embodiments include a payment terminal, with corresponding methods, and computer-readable media, which includes a first interface and a second interface. The first interface receives transaction information from an existing interface of a sales device without modification to the sales device. The first interface also transmits first authorization information to the existing interface without requiring modification to the sales device, thereby enabling the sales device to monitor and authorize a transaction associated with the sales device. The second interface transmits authorization request information associated with the transaction to a payment authorization system. The authorization request information represents the payment information. The second interface receives authorization response information associated with the transaction from the payment authorization system. The first authorization information is based on the authorization response information, and the first authorization information does not include the payment information.

Owner:AERO VISION TECH

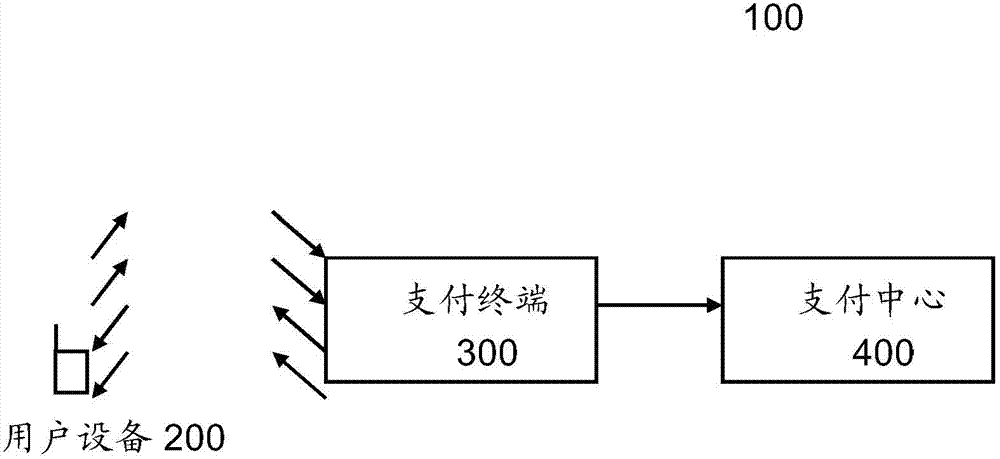

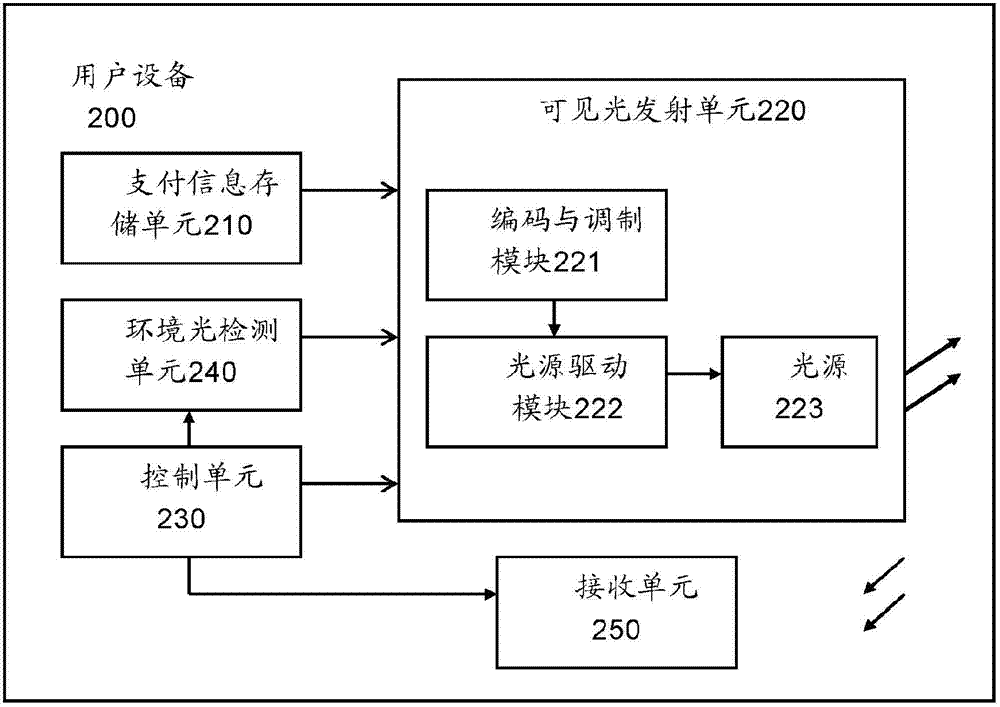

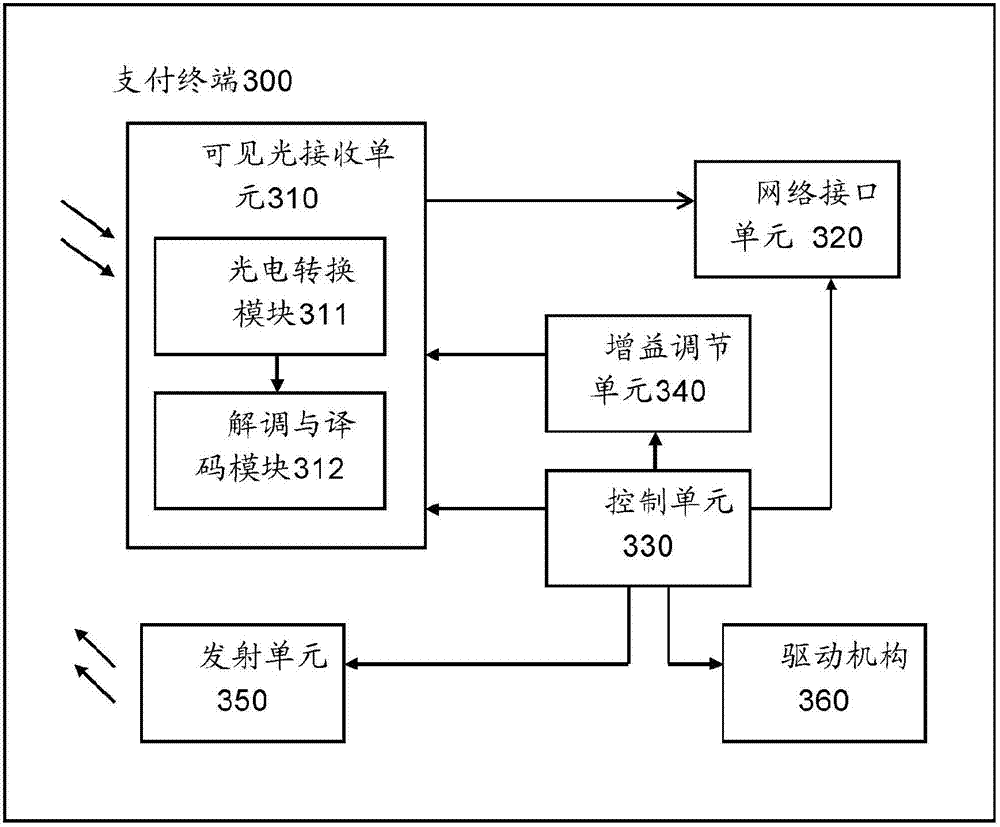

Mobile payment based on visible light communications

The invention provides a user device, a payment terminal, a system and a method, wherein the user device, the payment terminal, the system and the method are based on visible light communications to carry through payments. The user device comprises a payment information storage unit and a visible light emitting unit. The payment information storage unit is used for storing payment information which is relative to a user identity or an account. The visible light emitting unit comprises a coding and modulating module, a light source and a light source driving module, wherein the coding and modulation module is used for coding and modulating the information, and the light source driving module is used for driving the light source to light according to the modulated information. The user device further comprises a control unit, and the control unit is used for activating the visible light emitting unit to send the payment information to the payment terminal.

Owner:CHONGQING ZHUOHUI SCI & TECH

User interface for loyalty accounts and private label accounts

ActiveUS20160358167A1Faster and efficient method and interfaceReduce cognitive loadDiscounts/incentivesPoint-of-sale network systemsComputer terminalComputer science

The present disclosure generally relates to the use of loyalty accounts, private label payment accounts, and general payment accounts using an electronic device with an electronic wallet. Various accounts are linked to the electronic device. In some examples, the electronic device is NFC-enabled. The electronic device may be used to provide loyalty account information and payment account information to a payment terminal, such as an NFC-enabled payment terminal.

Owner:APPLE INC

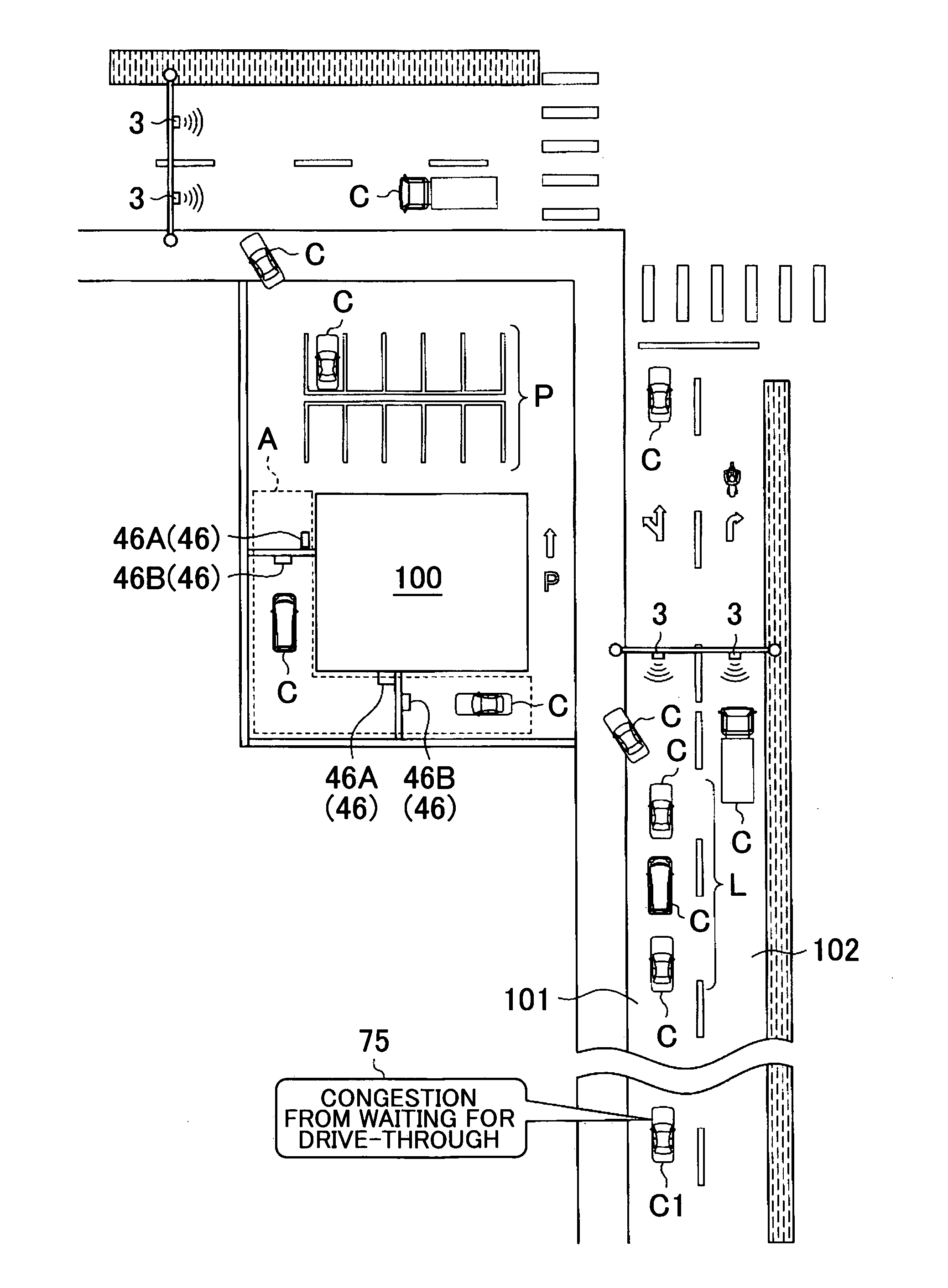

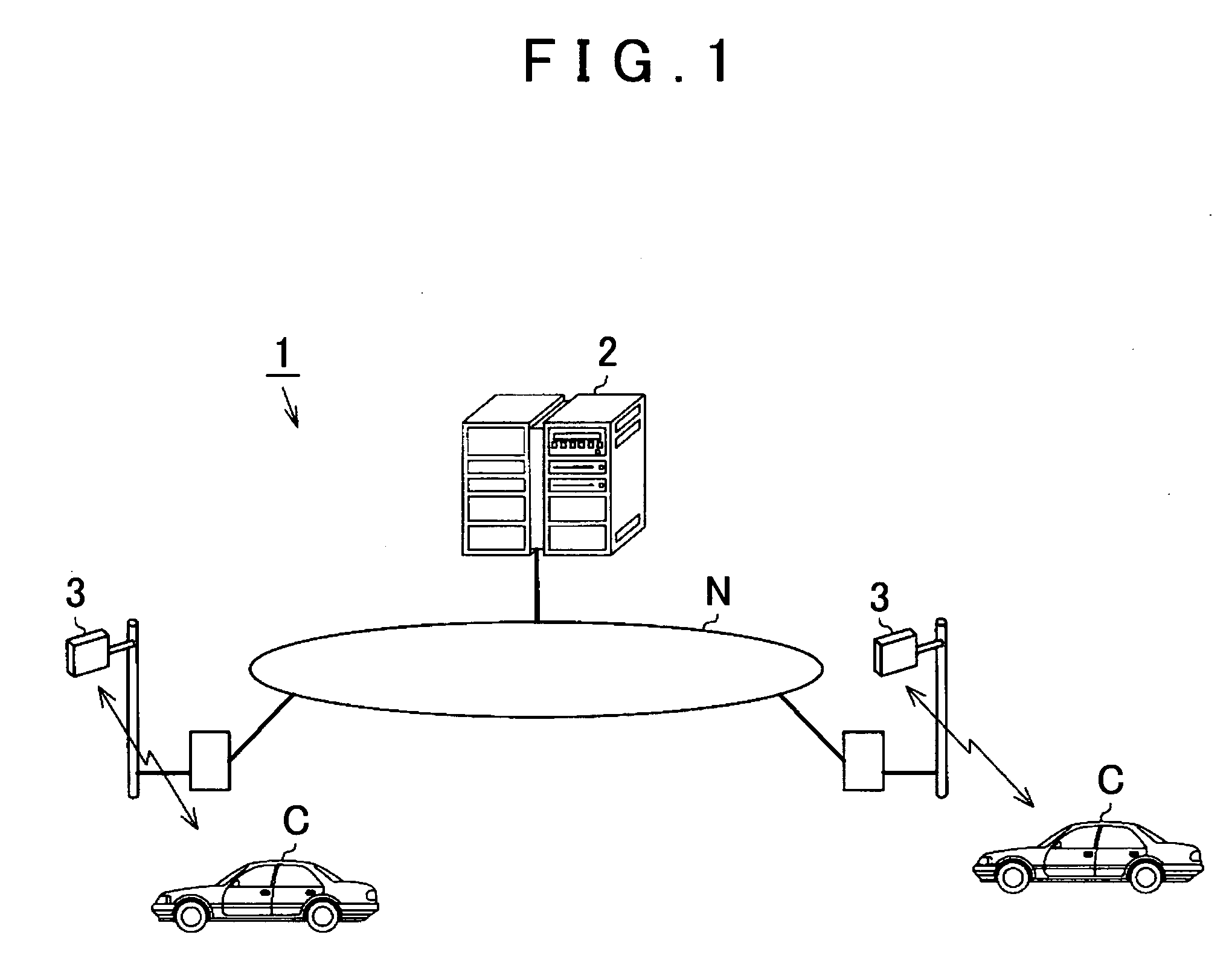

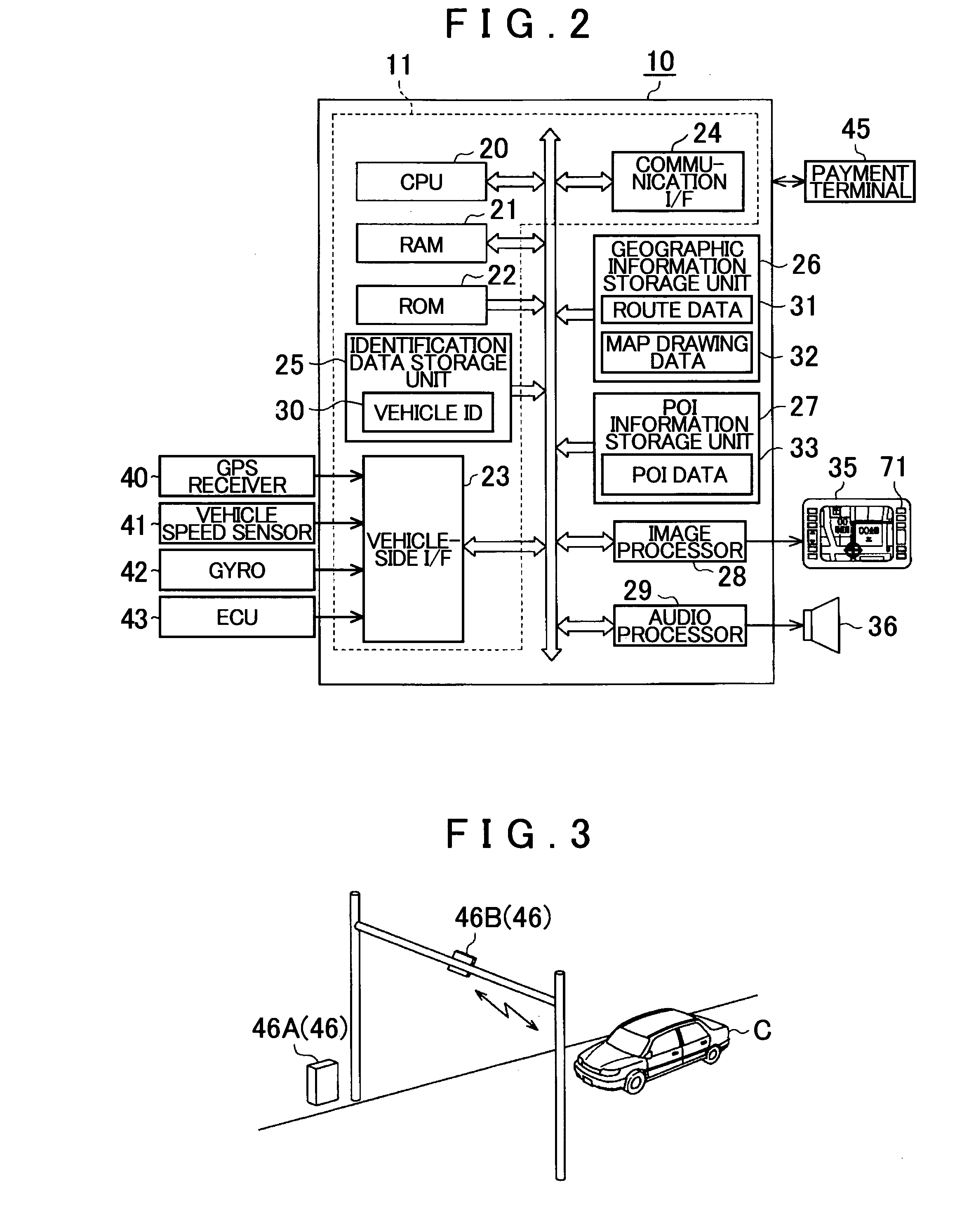

Traffic information processing system, statistical processing device, traffic information processing method, and traffic information processing program

ActiveUS20100174474A1Analogue computers for vehiclesInstruments for road network navigationInformation processingComputer terminal

A navigation device mounted in a vehicle determines a traffic condition when the vehicle travels in a road zone along a facility, and determines whether a payment terminal mounted in the vehicle has made a payment through communication with a facility terminal installed in the facility. If it is determined that a payment has been made through communication, then probe data is generated that associates the traffic condition in the road zone with a payment service of the facility.

Owner:AISIN AW CO LTD

User interface for loyalty accounts and private label accounts for a wearable device

ActiveUS20160358134A1Improve effectivenessImprove efficiencyApparatus for meter-controlled dispensingPoint-of-sale network systemsComputer terminalHuman–computer interaction

The present disclosure generally relates to the use of loyalty accounts, private label payment accounts, and general payment accounts using a wearable electronic device with an electronic wallet. Various accounts are linked to the electronic device. In some examples, the electronic device is NFC-enabled. The electronic device may be used to provide loyalty account information and payment account information to a payment terminal, such as an NFC-enabled payment terminal.

Owner:APPLE INC

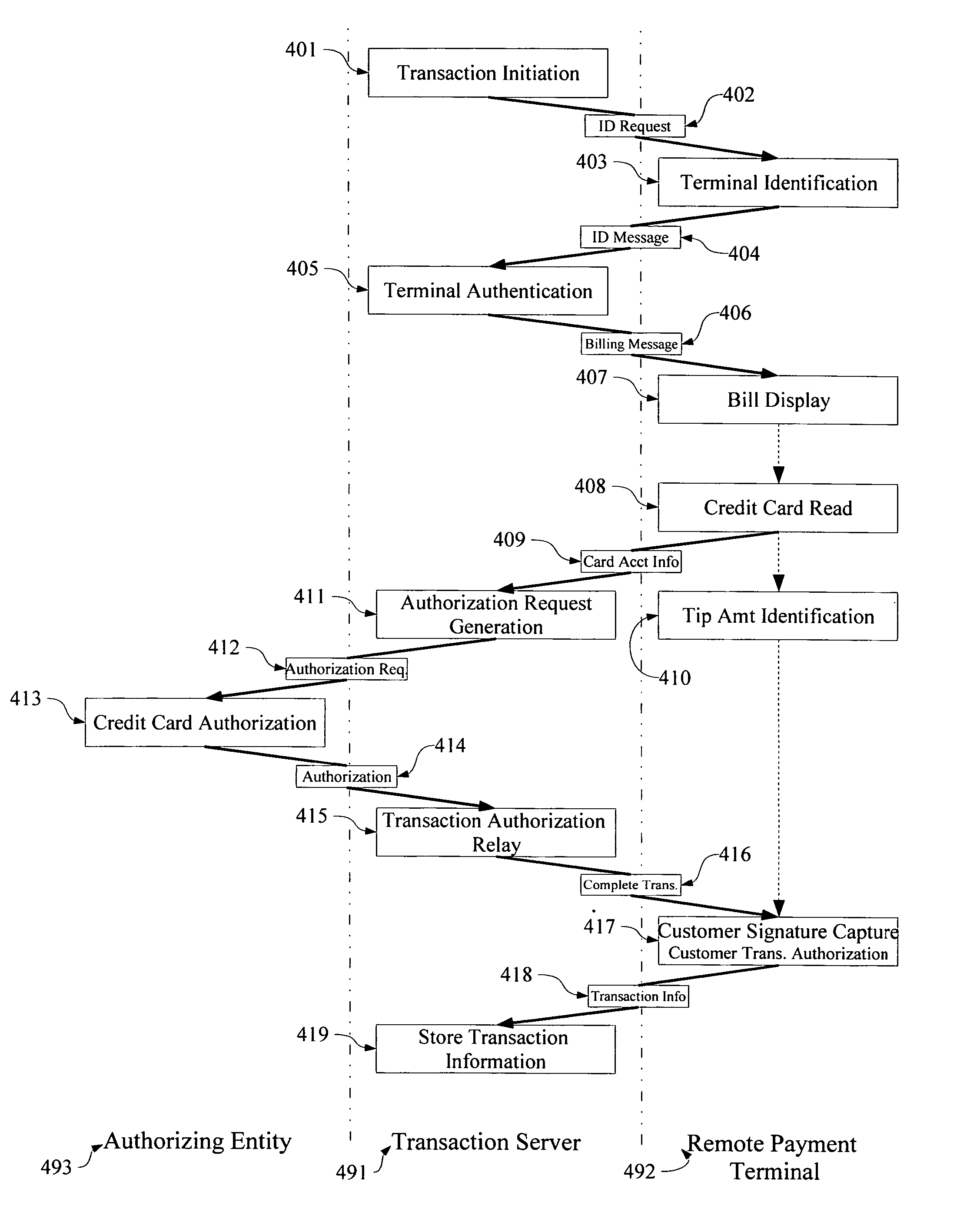

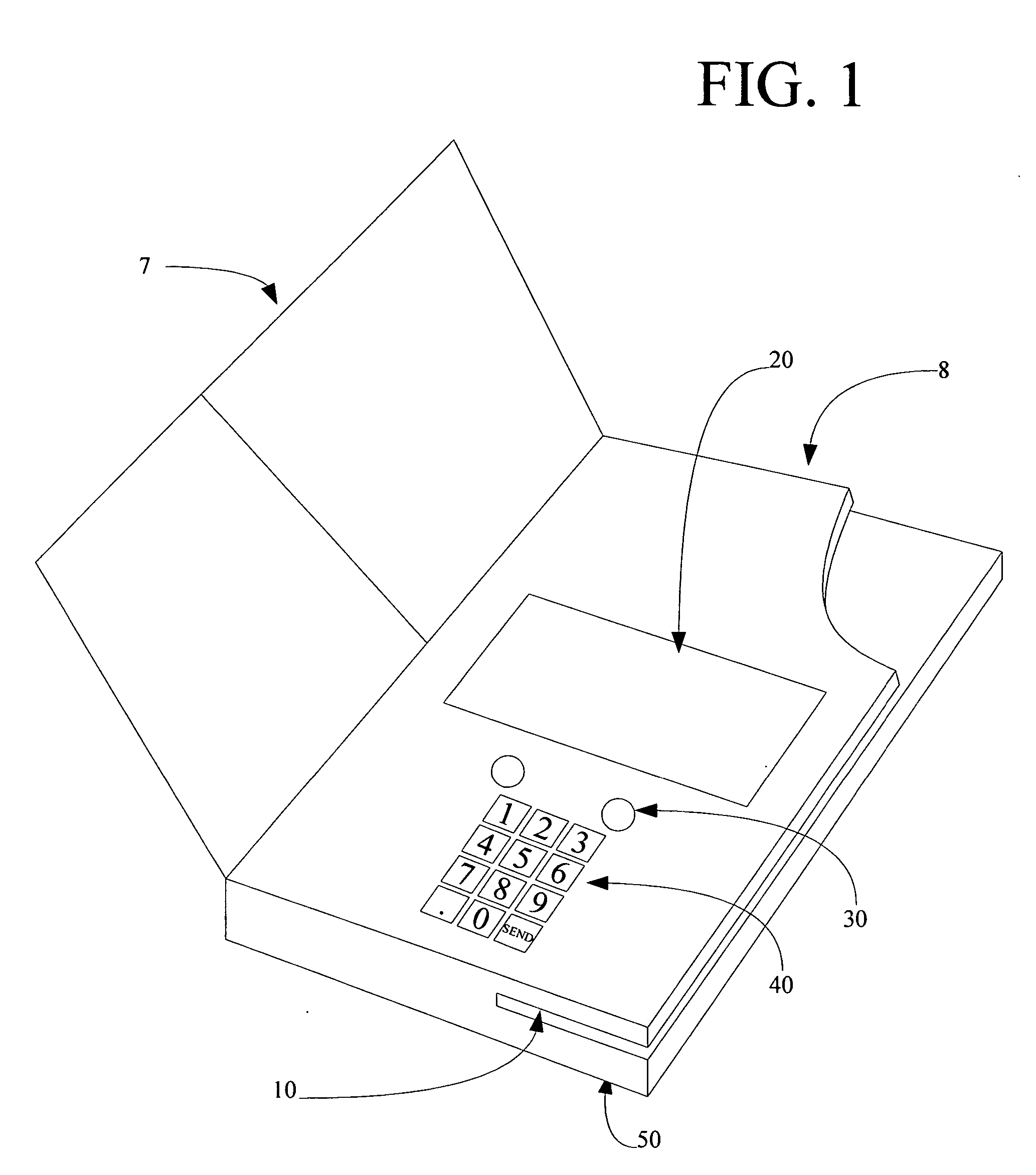

Remote payment terminal

InactiveUS20060064373A1Reduce workloadSimple and low-costAcutation objectsFinanceCredit cardAuthorization

A lightweight remote payment terminal is disclosed with the capability of capturing a tip amount and a signature authorizing a credit card transaction. The remote payment terminal allows diners to complete restaurant credit card transactions with minimal involvement from restaurant staff. A remote payment system is also disclosed that incorporates multiple remote payment terminals and one or more transaction servers. The transaction servers configure individual remote payment terminals with billing information, and the remote payment terminals capture information about credit cards that may be used for payment. A method of paying for credit card transactions is disclosed in which the non-tip portion of a bill is communicated to a remote terminal from a transaction server and the remote terminal is used to capture a tip amount and an authorizing signature. The transaction server obtains authorization to charge a credit card supplied by a user of the remote payment terminal either after or while the remote payment terminal captures information relating to the credit card transaction, including the user's signature.

Owner:KELLEY CHRISTOPHER LEE

User interface for loyalty accounts and private label accounts

ActiveUS20160358199A1Improve effectivenessImprove efficiencyDiscounts/incentivesPoint-of-sale network systemsComputer terminalUser interface

The present disclosure generally relates to the use of loyalty accounts, private label payment accounts, and general payment accounts using an electronic device with an electronic wallet. Various accounts are linked to the electronic device. In some examples, the electronic device is NFC-enabled. The electronic device may be used to provide loyalty account information and payment account information to a payment terminal, such as an NFC-enabled payment terminal.

Owner:APPLE INC

User interface for loyalty accounts and private label accounts for a wearable device

InactiveUS20160358133A1Improve effectivenessImprove efficiencyApparatus for meter-controlled dispensingPoint-of-sale network systemsHuman–computer interactionWearable Electronic Device

The present disclosure generally relates to the use of loyalty accounts, private label payment accounts, and general payment accounts using a wearable electronic device with an electronic wallet. Various accounts are linked to the electronic device. In some examples, the electronic device is NFC-enabled. The electronic device may be used to provide loyalty account information and payment account information to a payment terminal, such as an NFC-enabled payment terminal.

Owner:APPLE INC

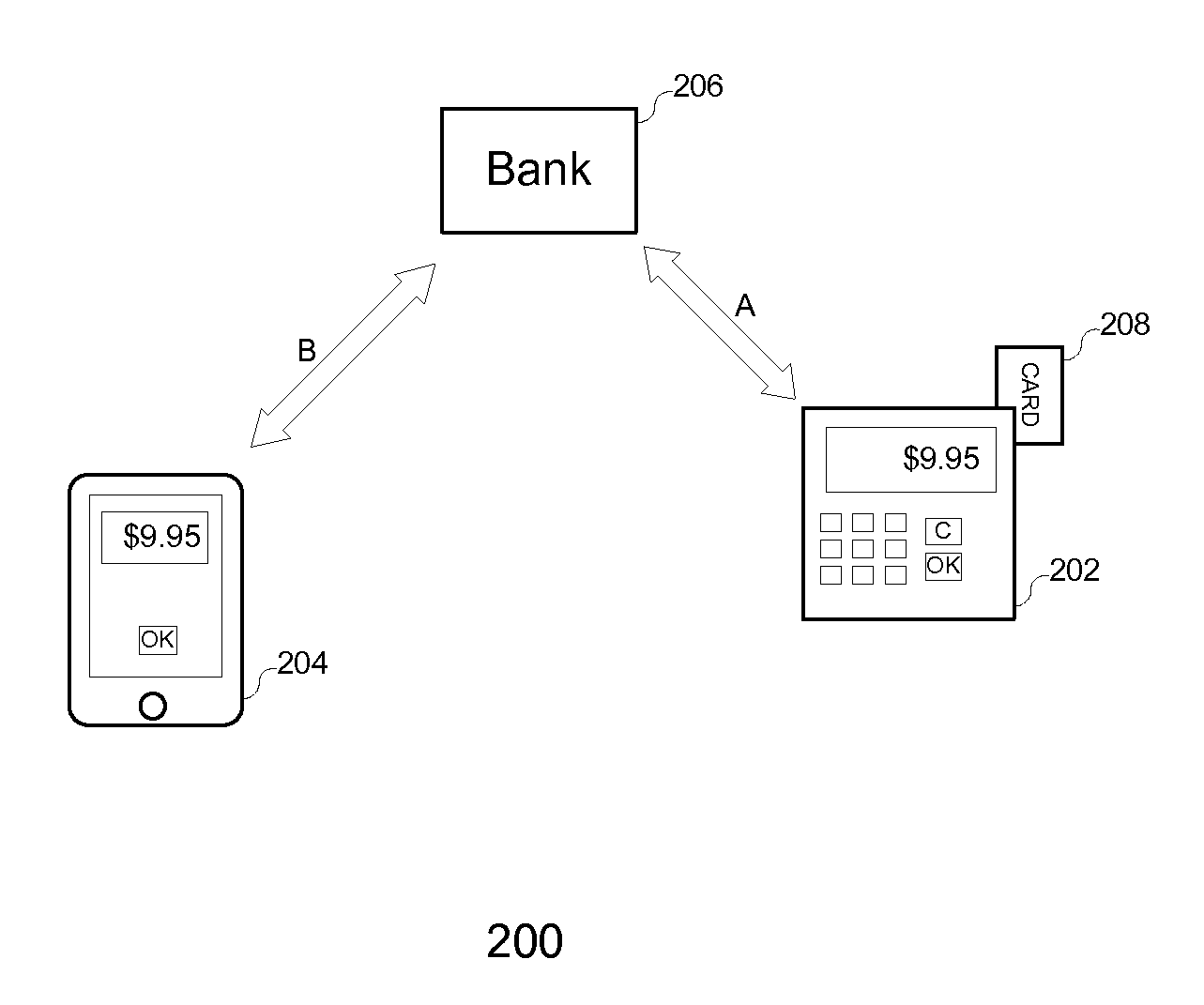

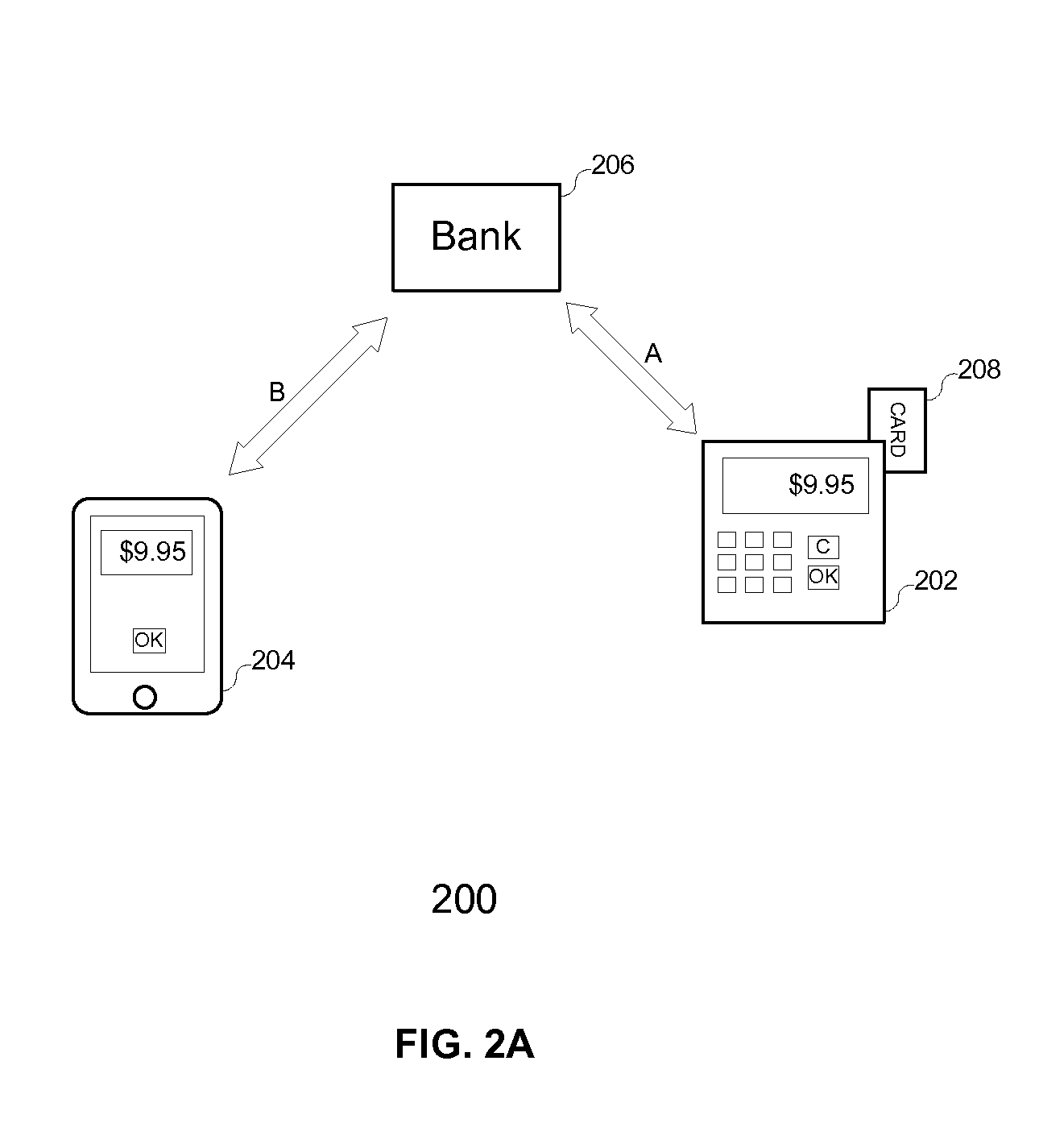

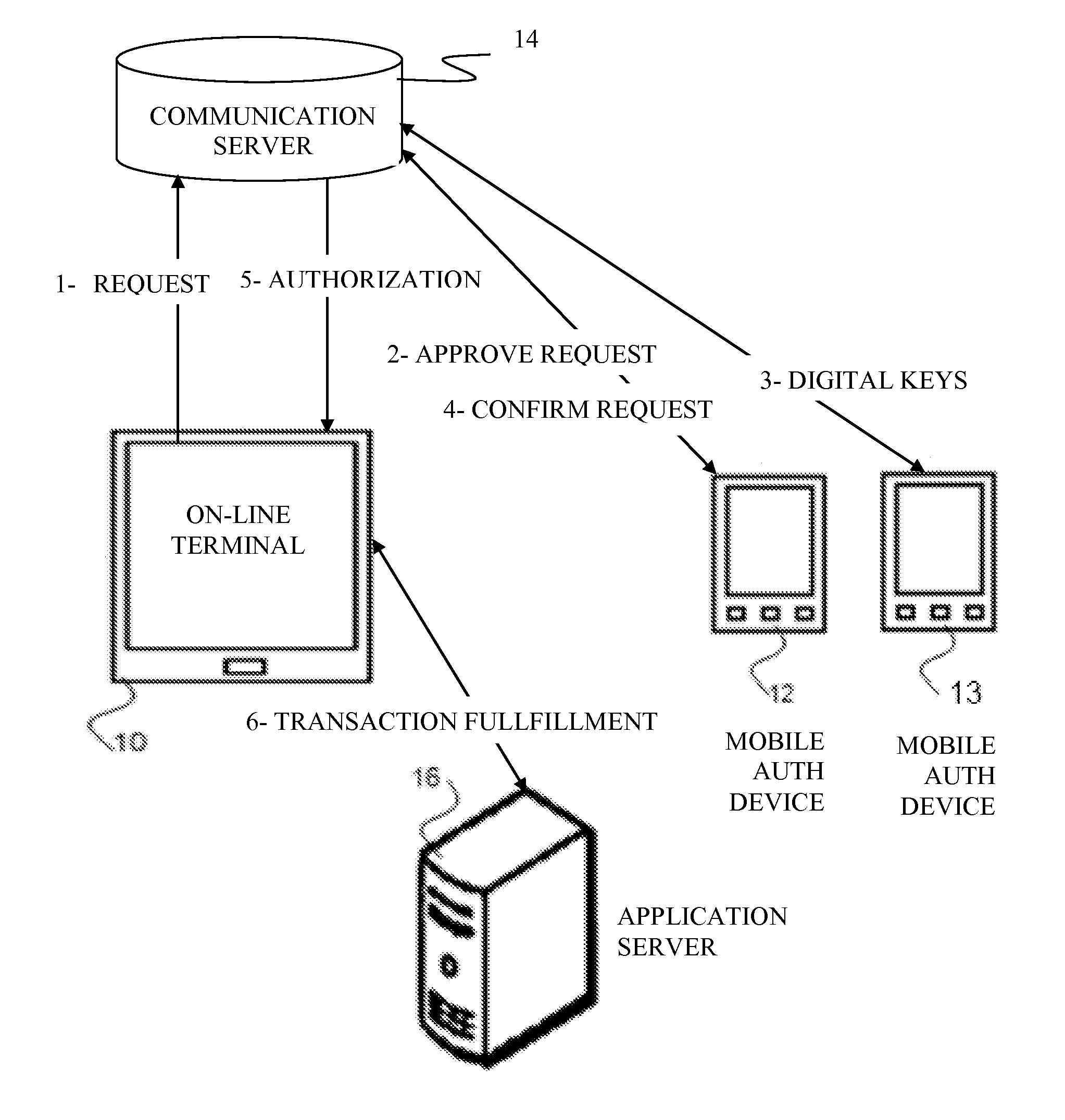

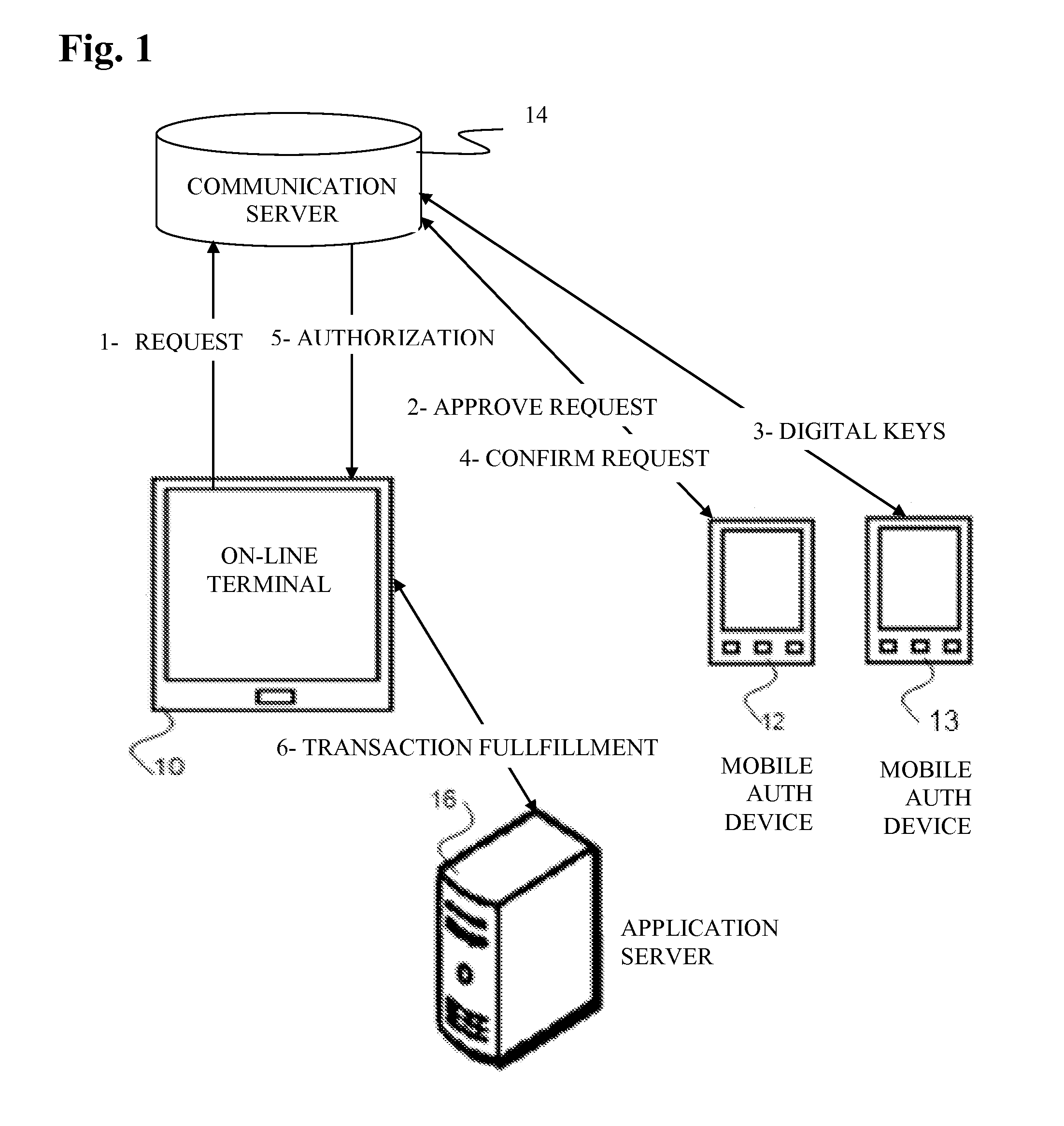

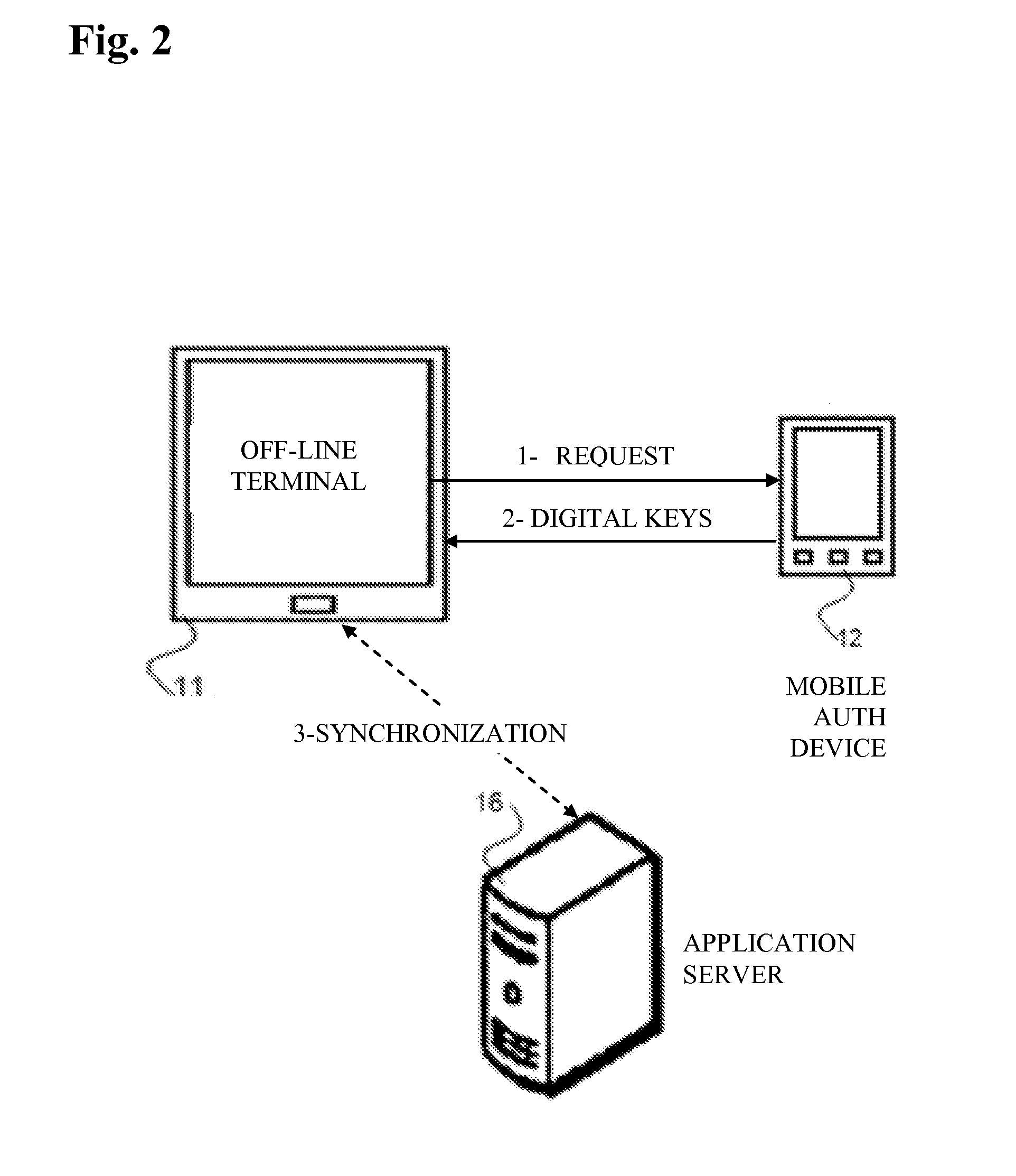

Secure Payments with Untrusted Devices

ActiveUS20140006190A1Point-of-sale network systemsCoded identity card or credit card actuationComputer terminalSecurity level

Various embodiments of the present invention relate to a point-of-sale (POS) system, and more particularly, to systems, devices and methods of making secure payments using a mobile device in addition to a POS terminal that may be an insecure payment device exposed to various tamper attempts under certain circumstances. The mobile device is involved in a trusted transaction between a central financial entity, e.g., a bank, and the payment terminal, such that the insecure payment terminal may be further authenticated based on rolling codes, two-way or three-way authentication, or an off-line mode enabled by incorporation of the mobile device. Although either of the mobile device and the payment terminal provides limited security, a POS system incorporating both of them demonstrates an enhanced level of security.

Owner:MAXIM INTEGRATED PROD INC

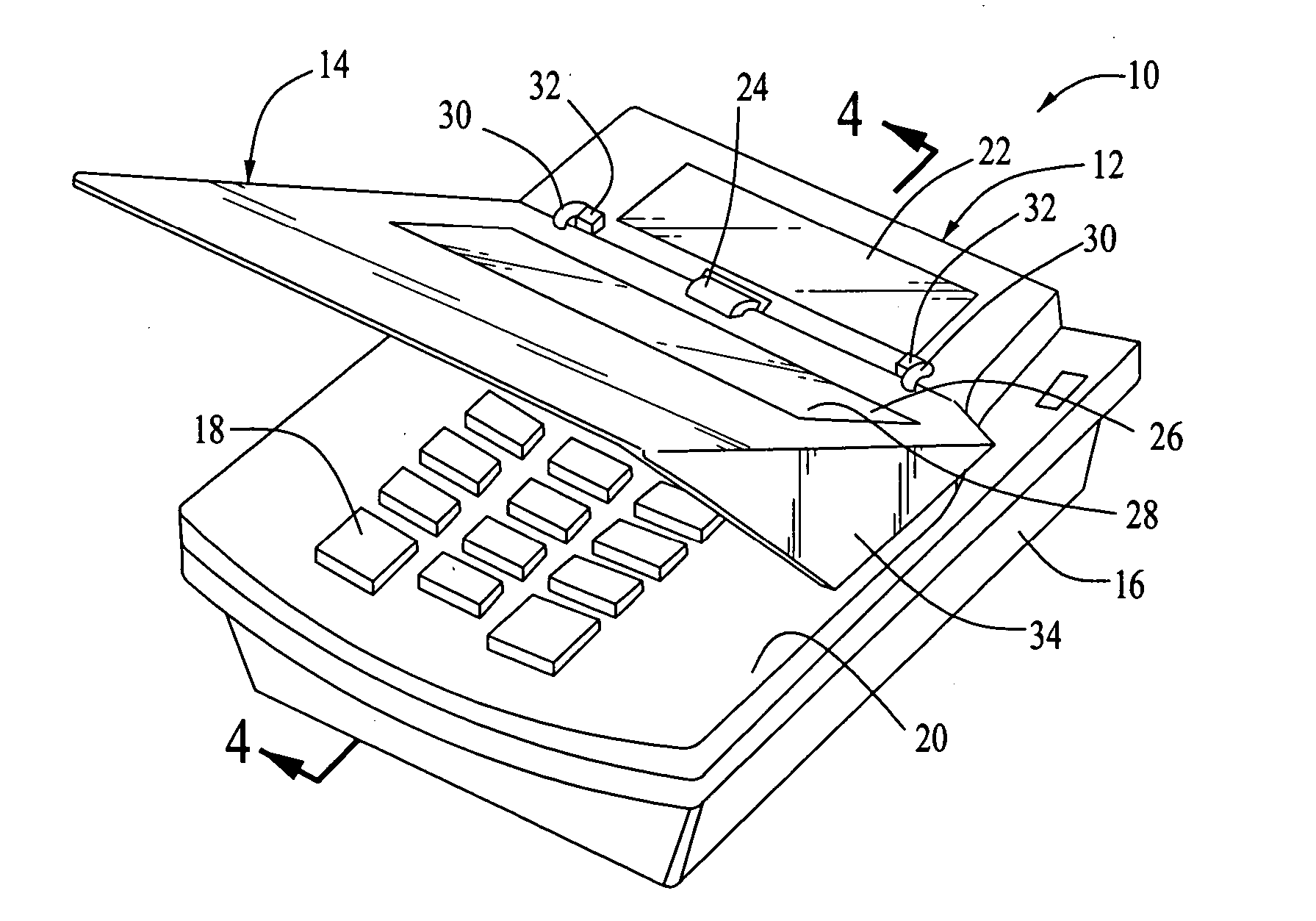

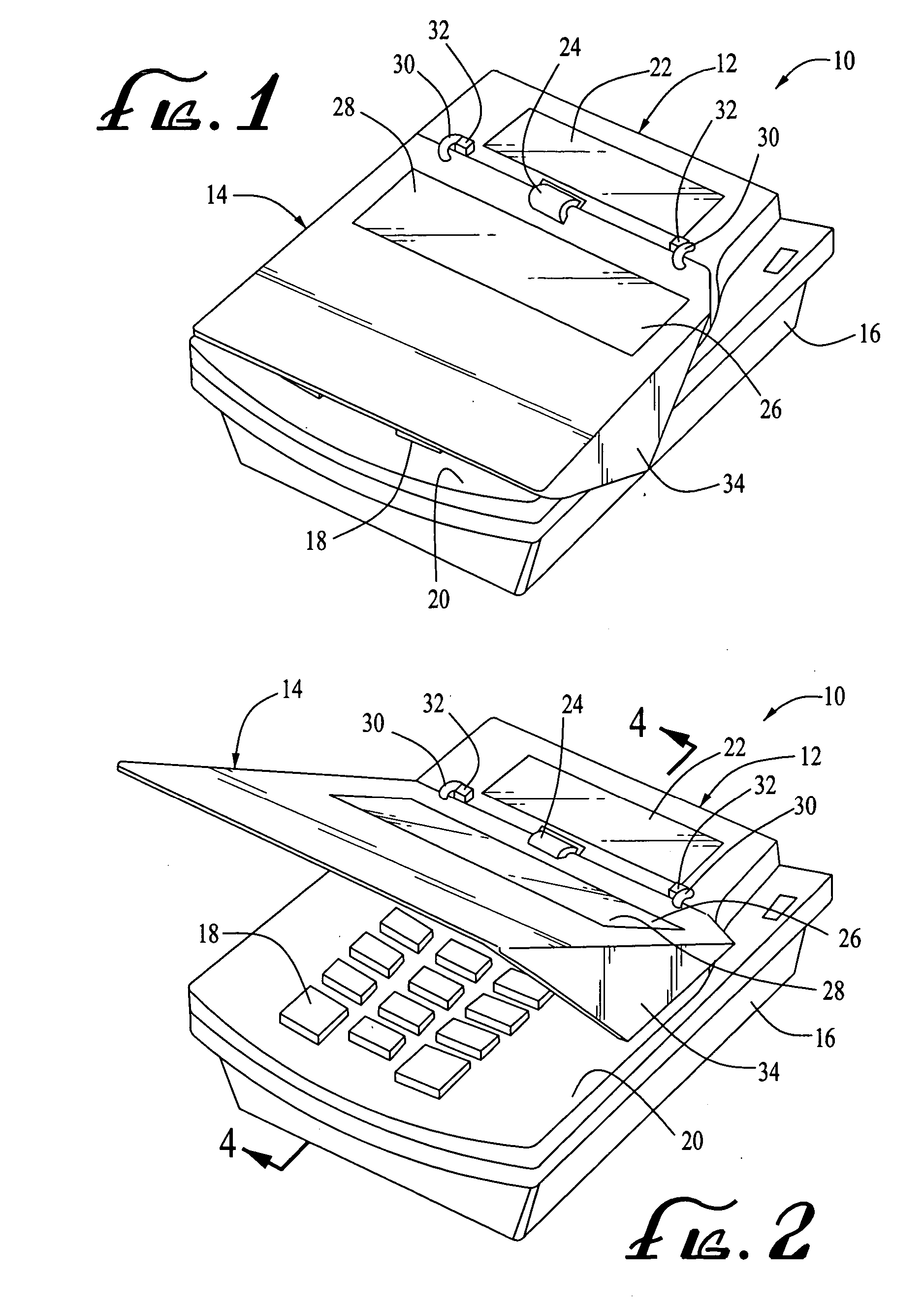

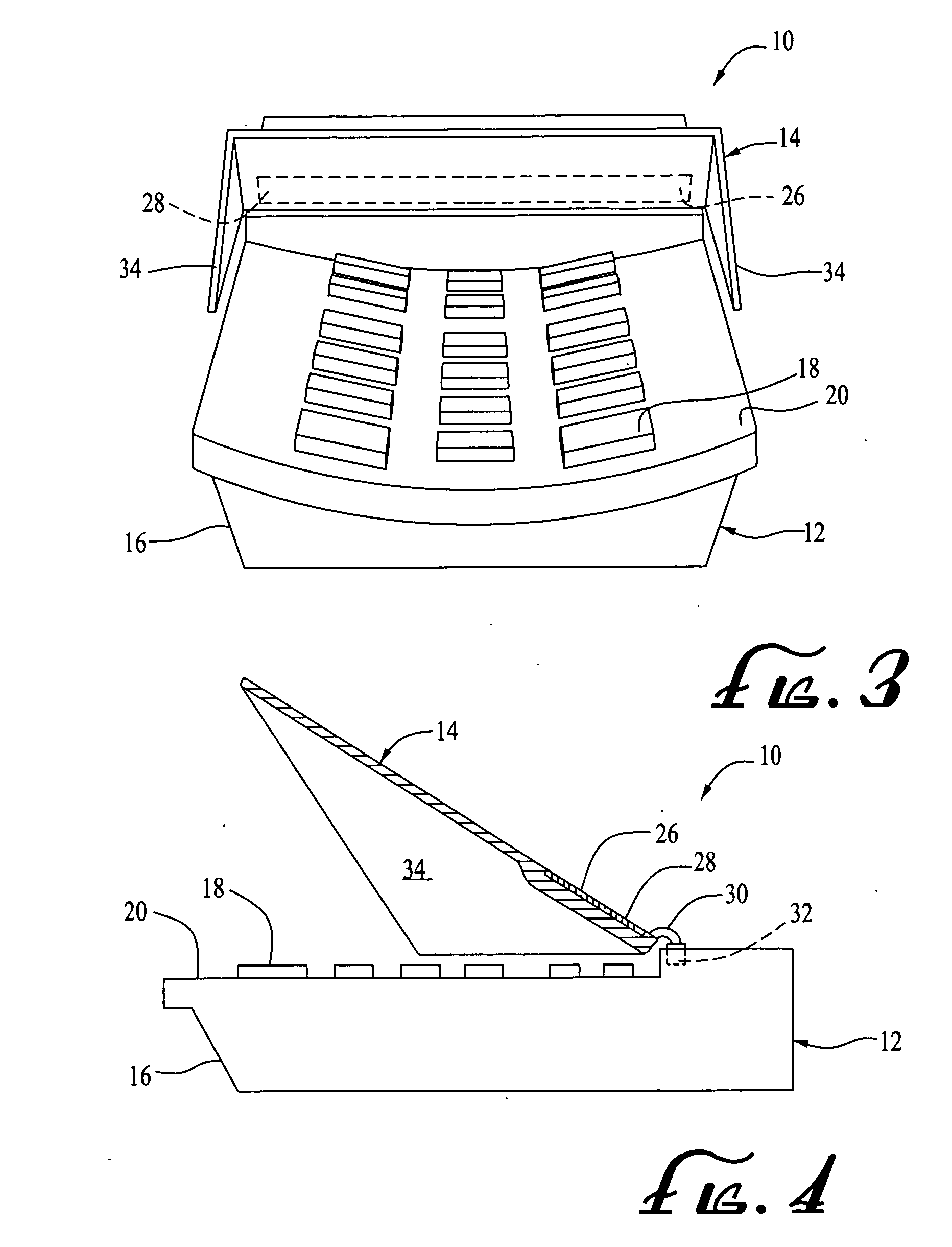

Electronic payment terminal with active cover

InactiveUS20060158434A1Input/output for user-computer interactionCathode-ray tube indicatorsEngineeringPayment terminal

An apparatus useful in facilitating commercial transaction payments as a secured electronic payment terminal and a thin keyboard cover. The keyboard cover is adjustably attached to the electronic payment terminal so that the keyboard cover can alternatively serve to cover the keyboard or to swing away from the keyboard to provide a security panel. The keyboard cover is “active,” in that it incorporates a data communicator for transmitting or receiving data from an outside source. In one embodiment, the data communicator includes a signature pad. The keyboard cover is removable from the electronic payment terminal for maintenance and / or replacement without having to access the internals of the electronic payment terminal, including its electronic circuitry.

Owner:ZANK ANTHONY E +1

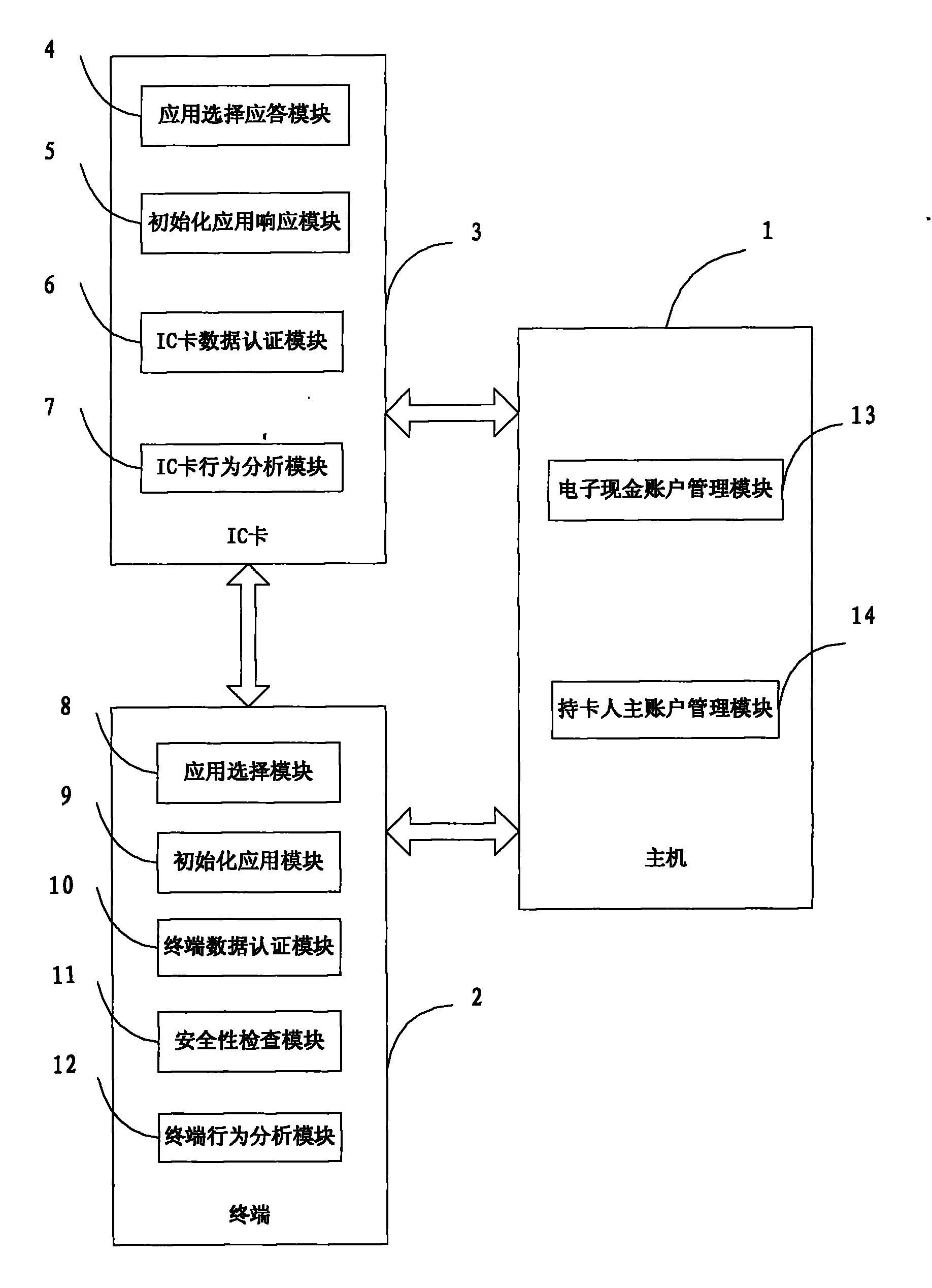

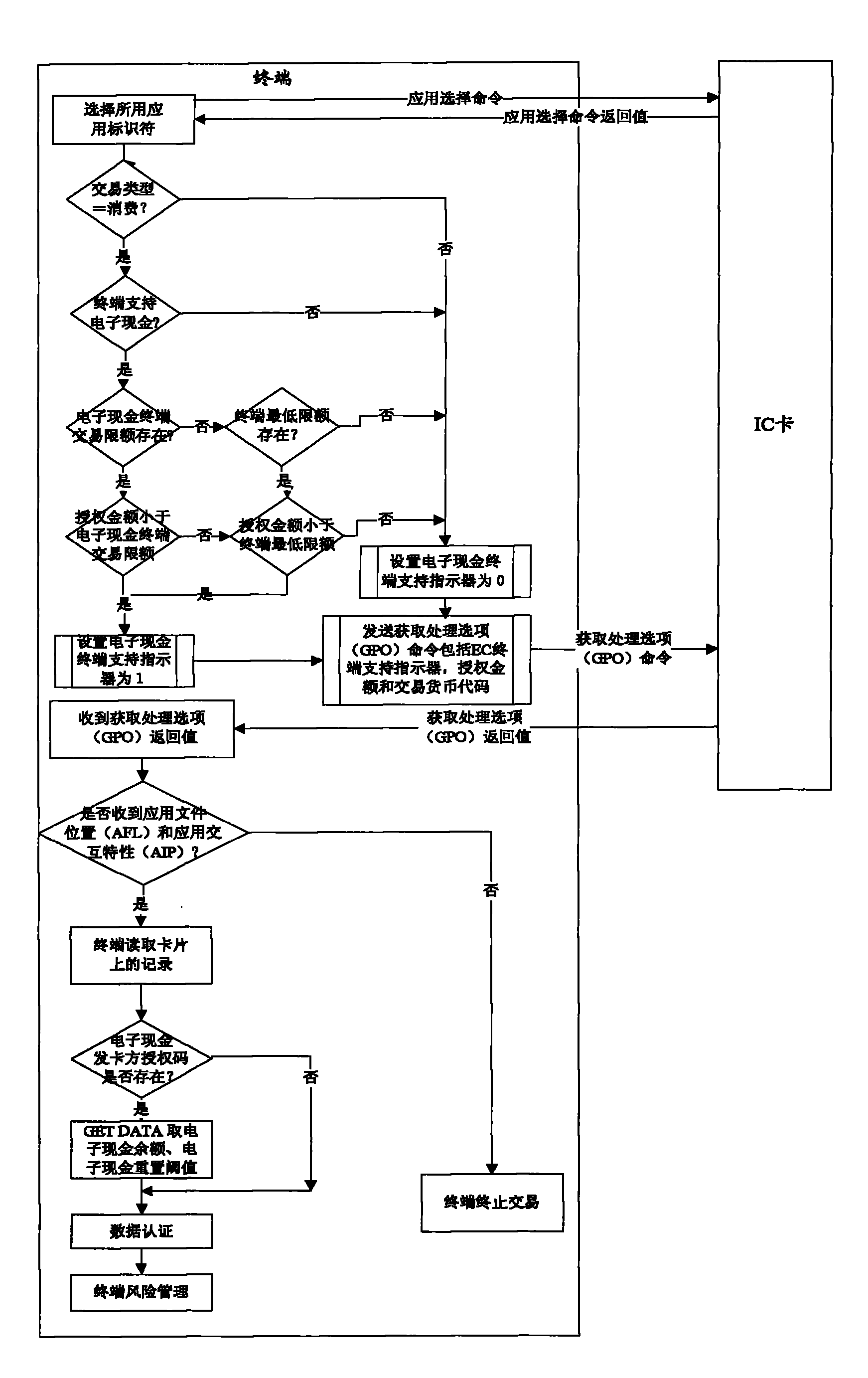

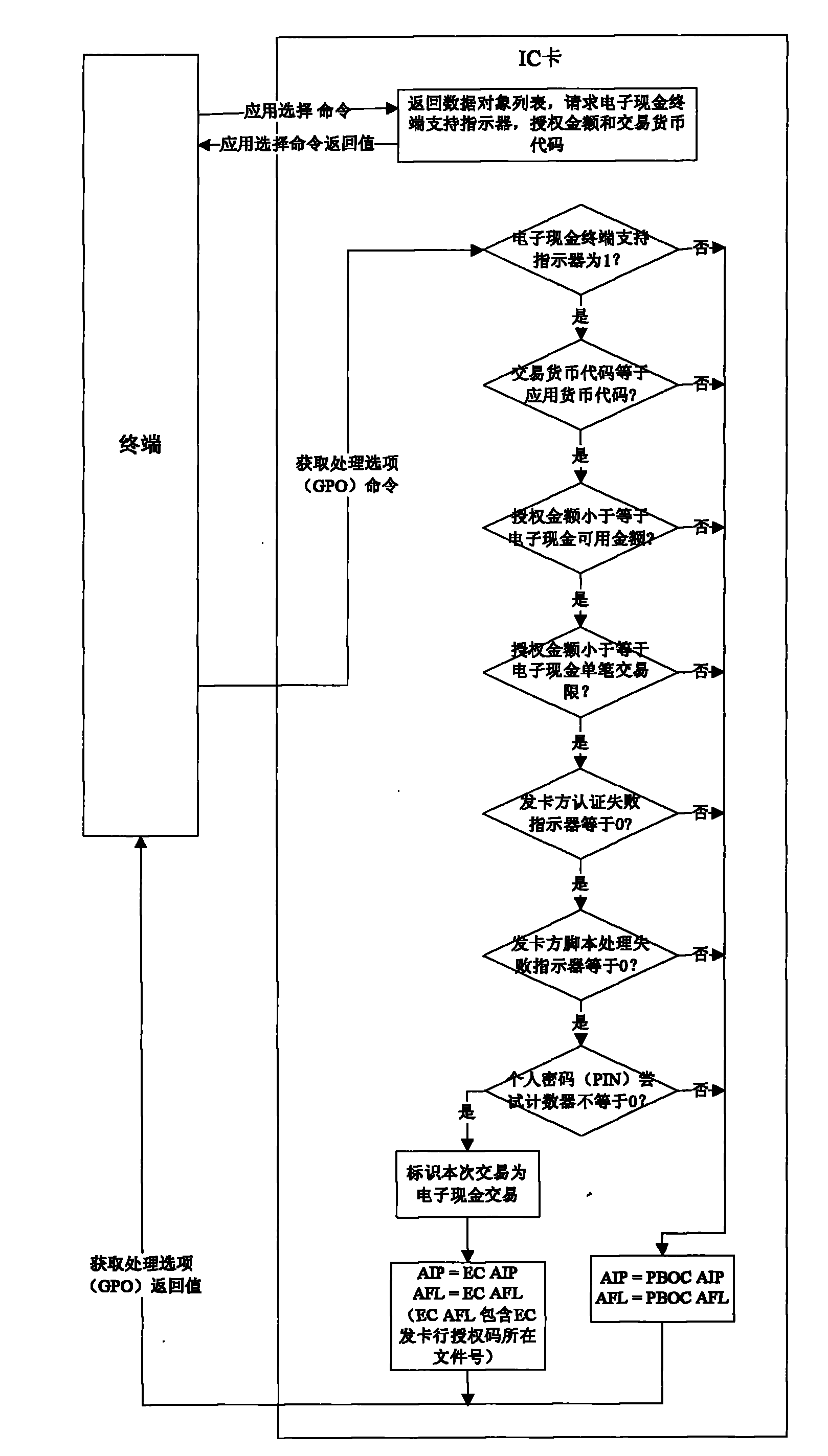

IC (integrated circuit) card paying system and method as well as multi-application IC card and payment terminal

ActiveCN102081821AImprove securityNo hidden danger of attackComplete banking machinesPoint-of-sale network systemsIntegrated circuit layoutComputer terminal

The invention provides an IC (integrated circuit) card paying system and method as well as a multi-application IC card and a payment terminal. The invention has the following advantages: during offline transaction, the terminal and the IC card adopt an asymmetric key algorithm to authenticate offline data, and if the offline transaction is not approved, the terminal and the IC card carry out online transaction via a host, so the IC card paying system and method as well as the multi-application IC card and the payment terminal, which are disclosed by the invention, can be applied to machines and tools without online transaction environment and machines and tools, with online transaction environment, of standard merchants.

Owner:CHINA UNIONPAY

Method for adaptive wireless payment

InactiveUS8905303B1Special data processing applicationsProtocol authorisationComputer terminalSelf adaptive

A method for facilitating wireless payment using different authentication and connectivity methods depending on the user profile, the user location, transaction, and connectivity capabilities of the payment terminal.

Owner:OPTIMA DIRECT LLC

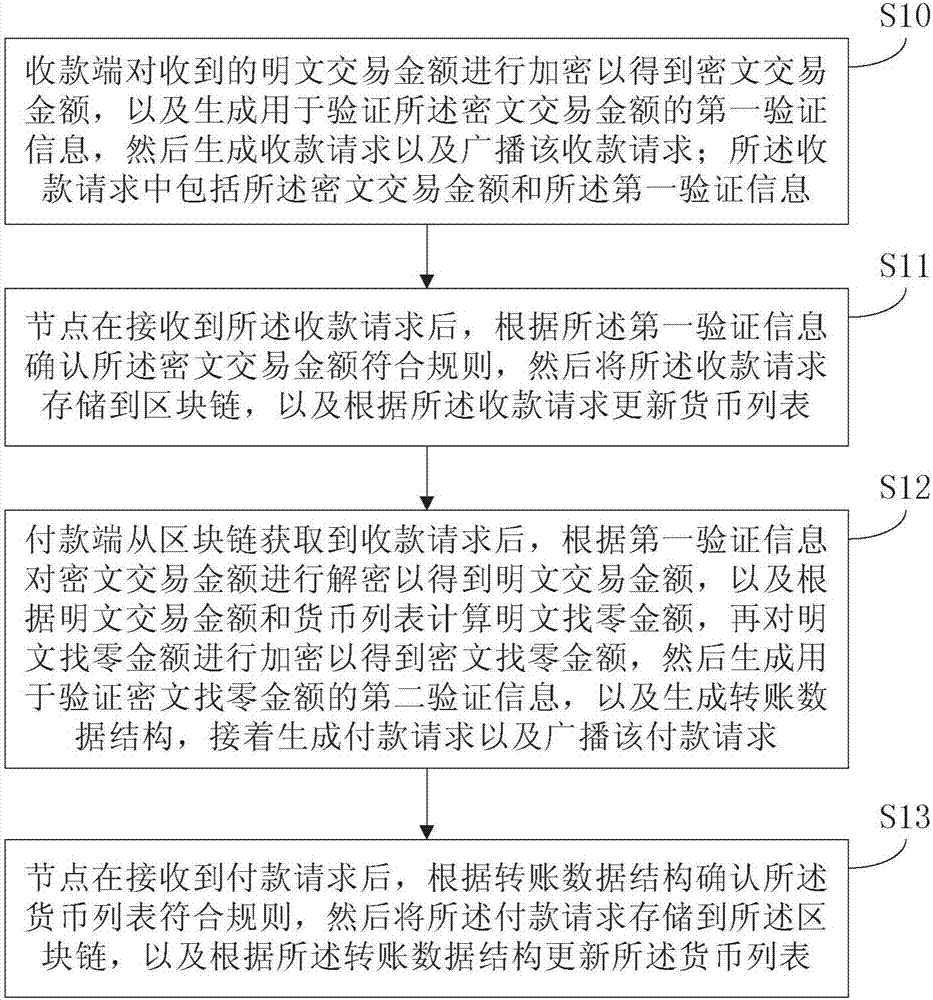

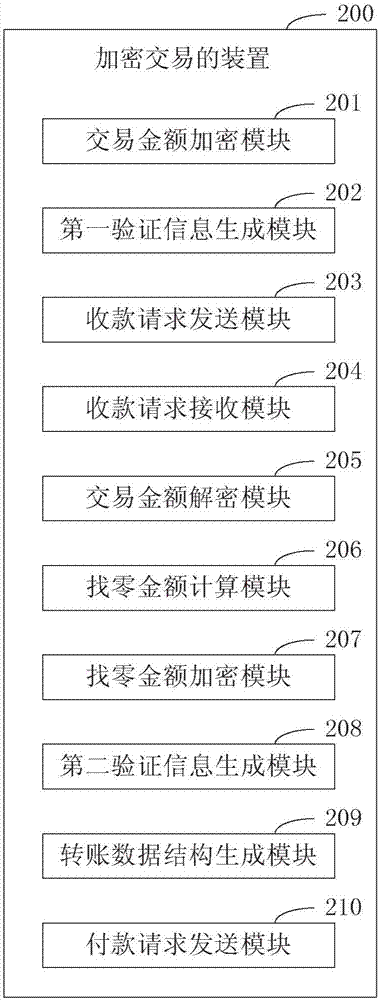

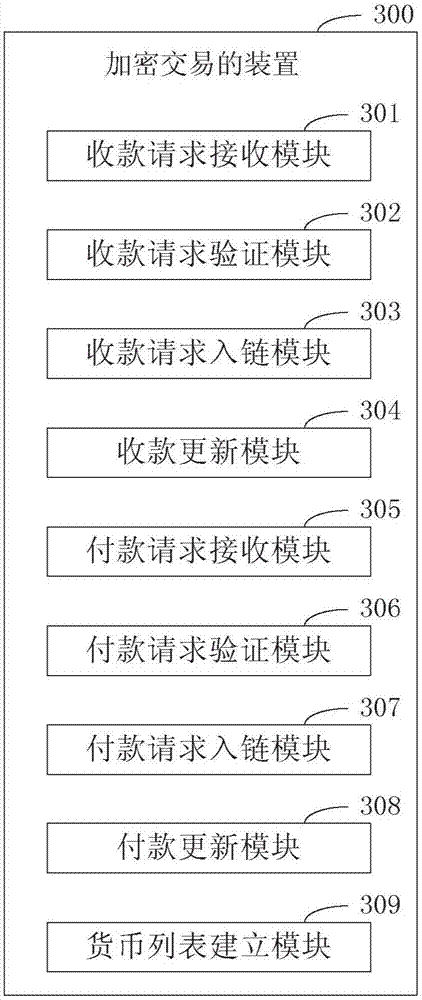

Transaction method and device based on digital currency

ActiveCN107358424AOvercome technical issues that are difficult to keep secretGuarantee cooperation and sharingPayment protocolsPlaintextDigital currency

The invention discloses a transaction method and device based on digital currency, relating to the computer technology field. The transaction method based on the digital currency comprises that: a money collection terminal and a money payment terminal encrypt amount of money which is proclaimed in a collection and payment transaction process based on the distributed account book technology in order to obtain an encrypted money amount; corresponding verification information is generated in order to perform verification and decryption on the encrypted money amount. The transaction method and device based on digital currency solve a technical problem that the current distributed account book technology is hard to be confidential, and reach technical effects that cooperation sharing is guaranteed and transaction privacy is protected.

Owner:THE PEOPLES BANK OF CHINA DIGITAL CURRENCY INST

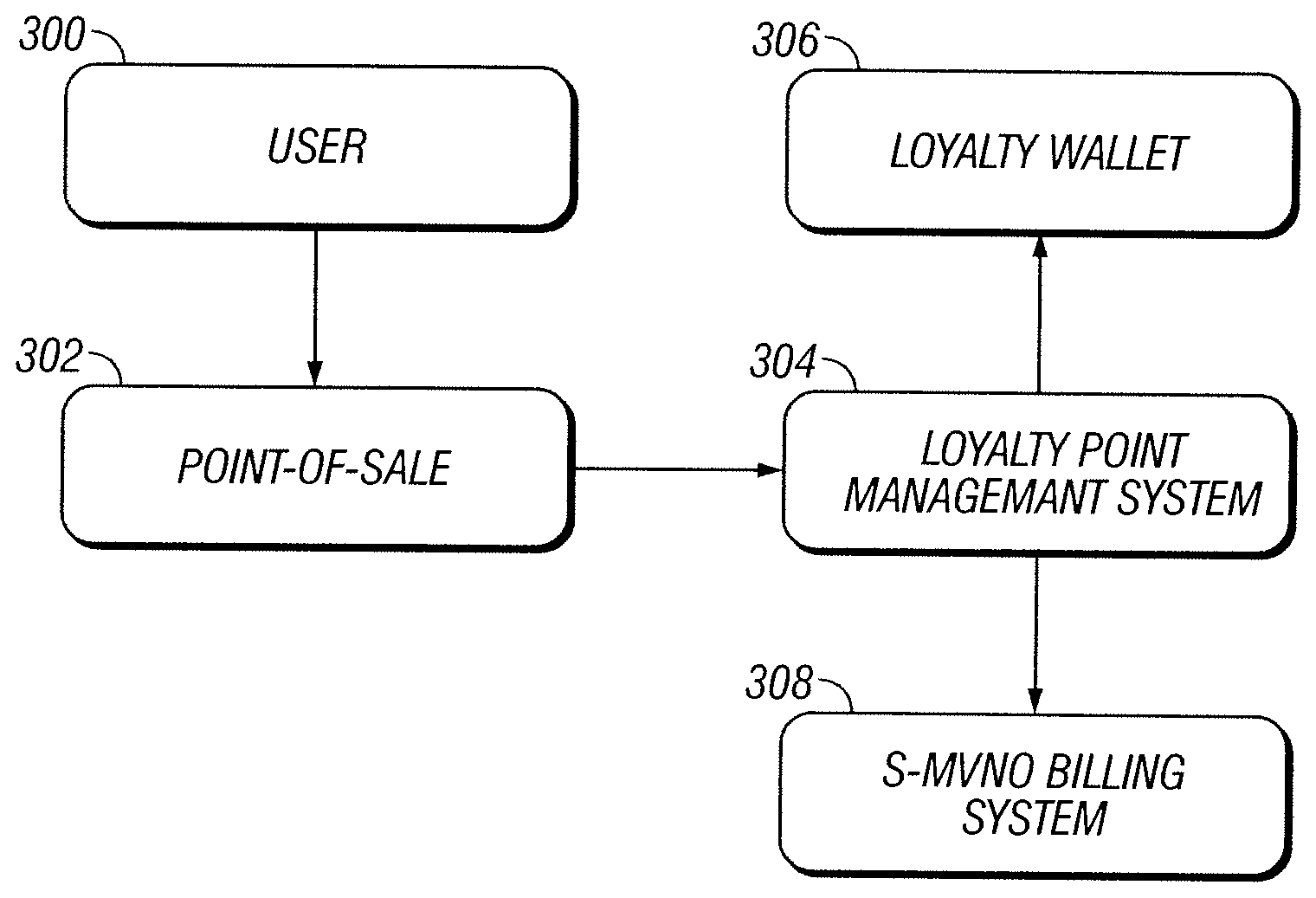

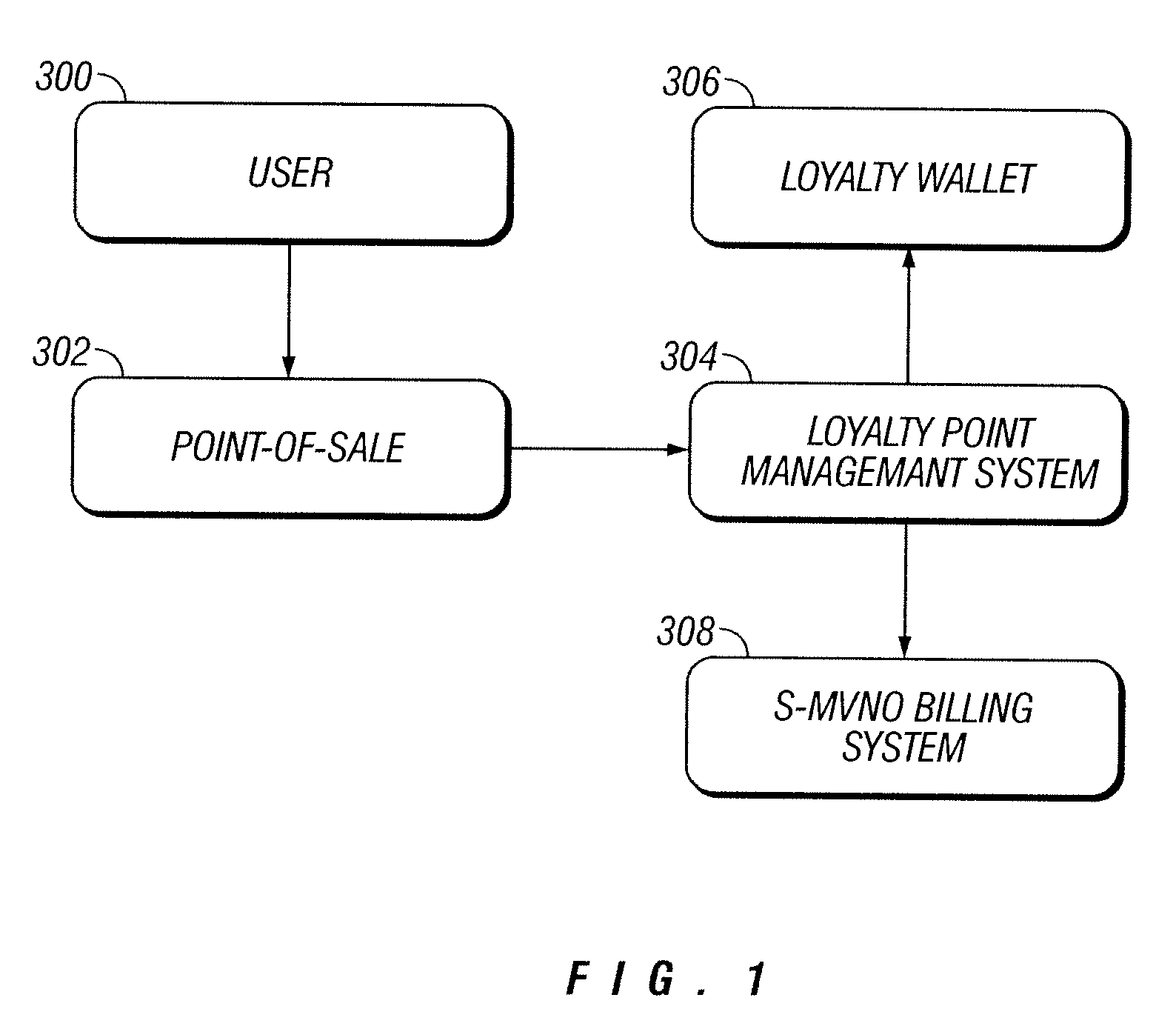

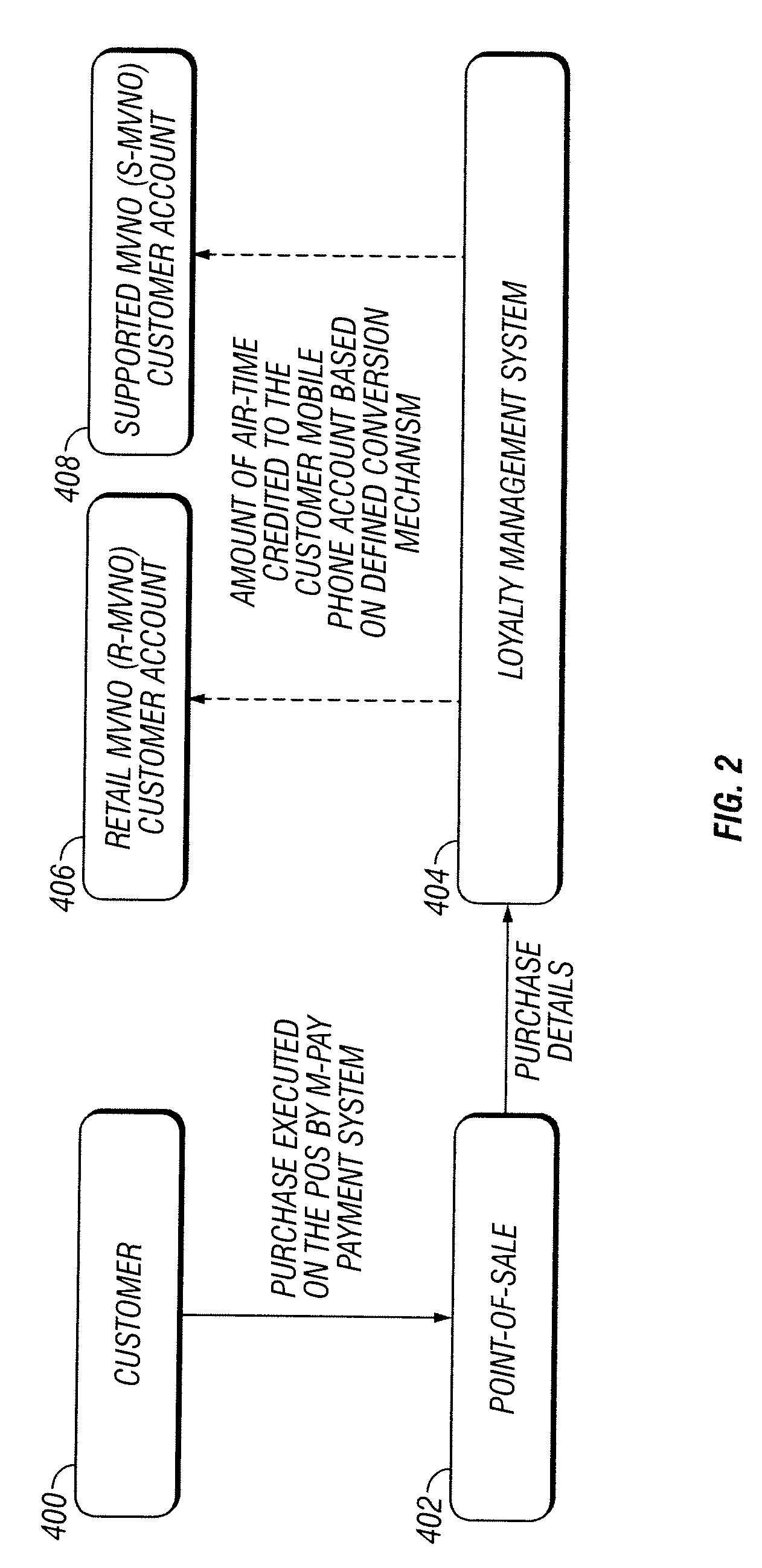

Method and system for collecting, receiving, and transferring transaction information for use by a bonus or loyalty program and electronic vouchers

InactiveUS20090138302A1Hand manipulated computer devicesTelephonic communicationTelecommunications linkLoyalty program

The present invention provides methods and systems for managing mobile virtual network operations. According to some embodiments, purchasing information, e.g., item, price, quantity, location, etc., may be collected using a mobile phone. The collected information may be used as part of a bonus or loyalty program. Collected information might be stored directly on a person's mobile phone. Alternatively, collected information might be stored by using the mobile phone to transfer the collected information to a server or servers. The system for tracking purchasing information may comprise a mobile communication device configured to connect to a transaction center via a mobile telephone network and to collect purchasing information for use by a loyalty program, a payment terminal device connected to a transaction center via a communication link, and a point of sale device, coupled to the payment terminal device and configured to provide items for purchase.

Owner:ULTRA D O O

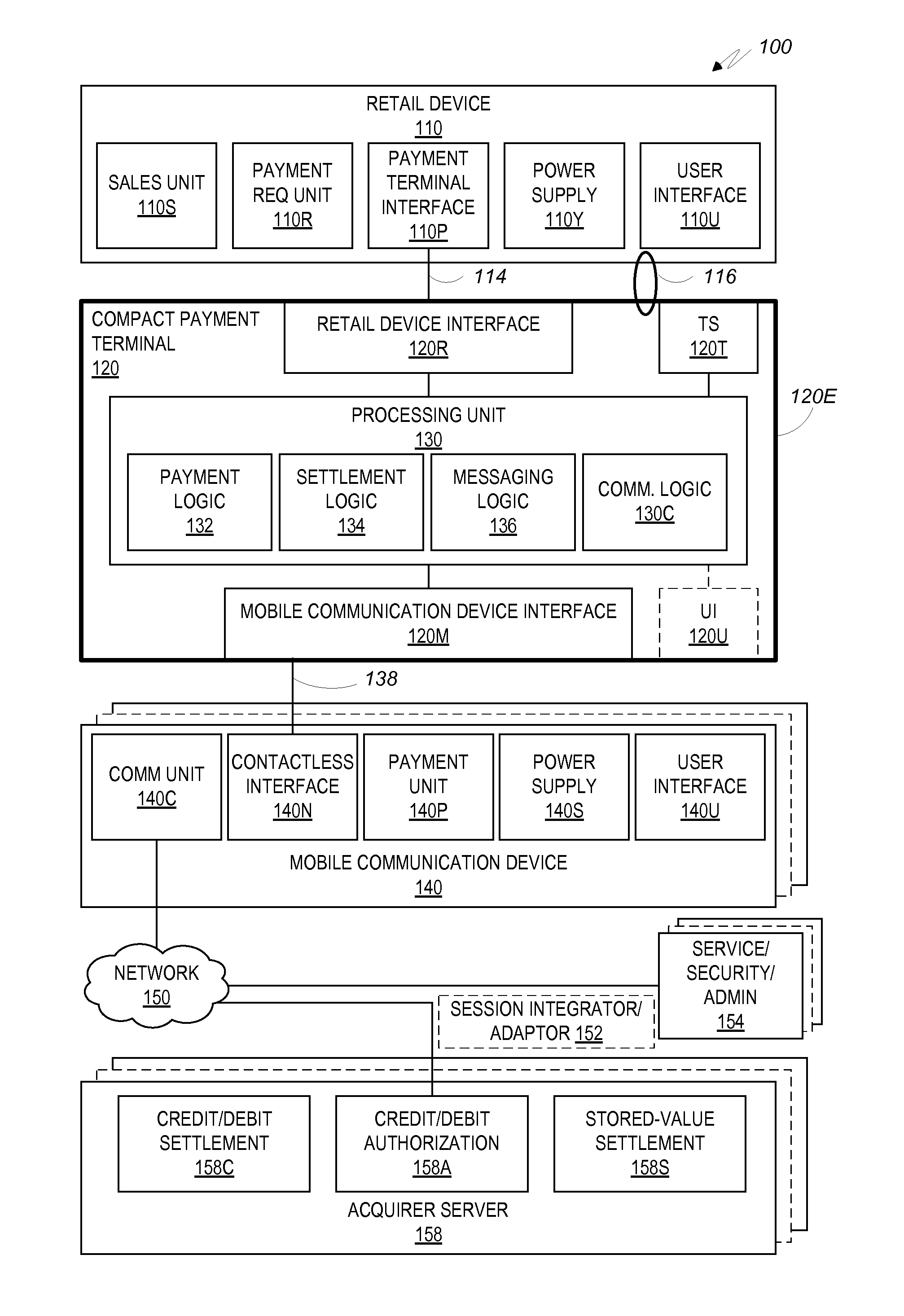

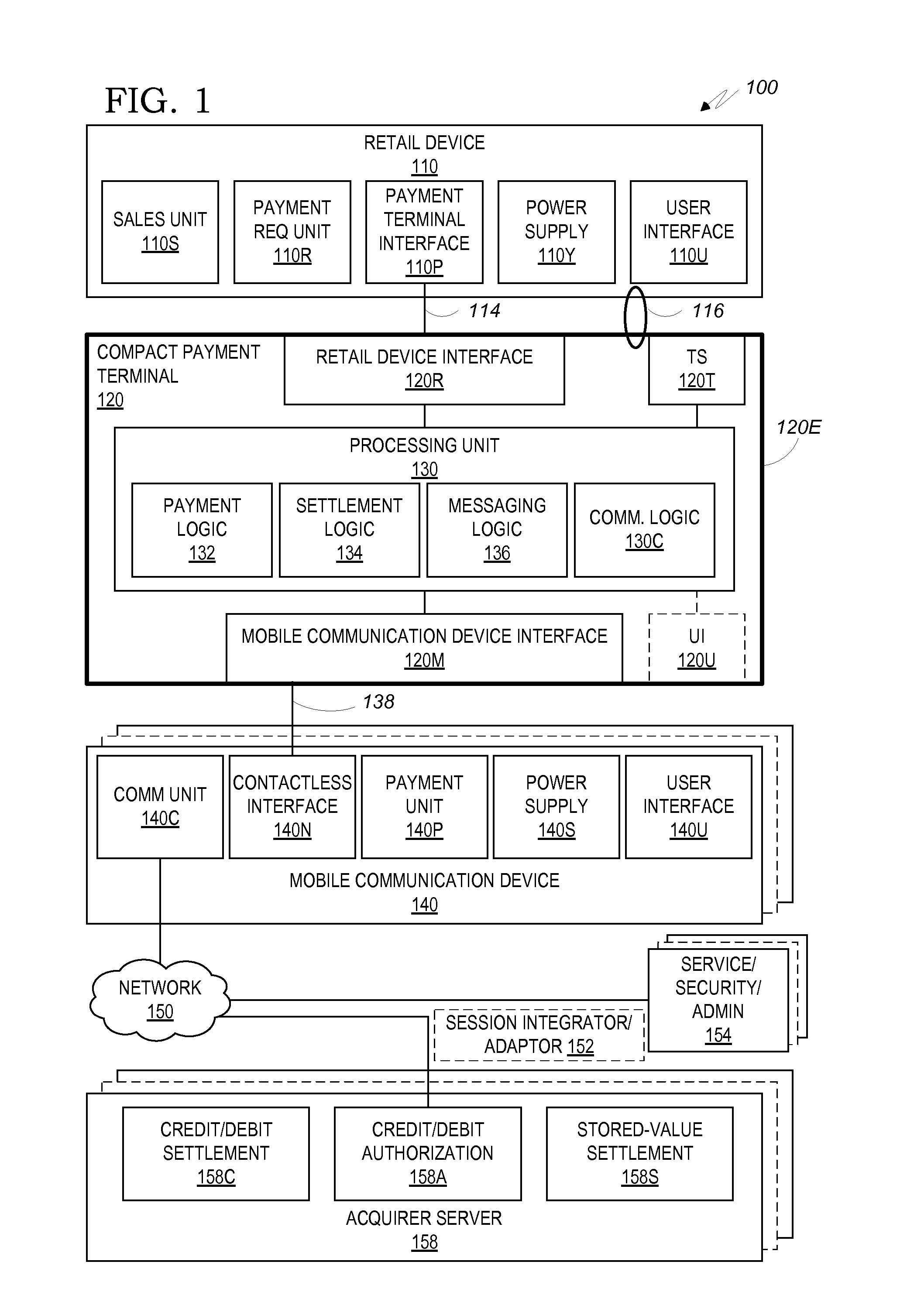

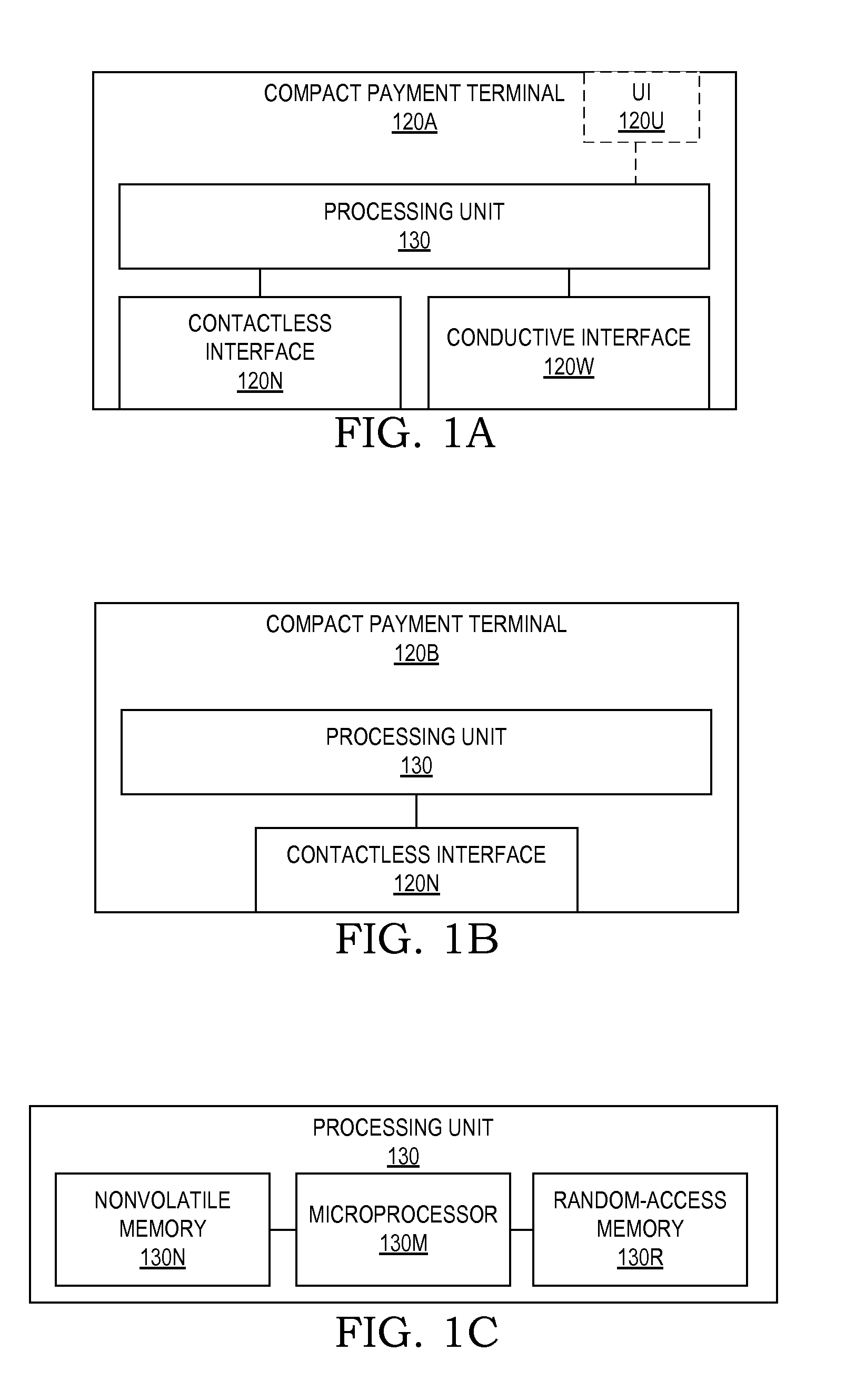

Compact payment terminal

InactiveUS20100312692A1Compact implementationFinanceSpecial service for subscribersPayment transactionComputer module

A compact payment terminal for operating upon a purchase made by a customer at a retail device is provided. The customer carries a mobile communication device that includes a payment module and a communication module. The compact payment terminal includes a first interface for interfacing with the retail device, a second interface for interfacing with the mobile communication device of the customer and a processing unit connected to the first and second interface. The compact payment terminal is configured to receive, via the first interface, a payment request from the retail device, cooperate, via the second interface, with the payment module of the mobile communication device for initiating a payment transaction respective to the payment request, and selectably conduct, via the second interface and the communication module of the mobile communication device, a communication session between the processing unit and at least one server.

Owner:TEICHER MORDECHAI

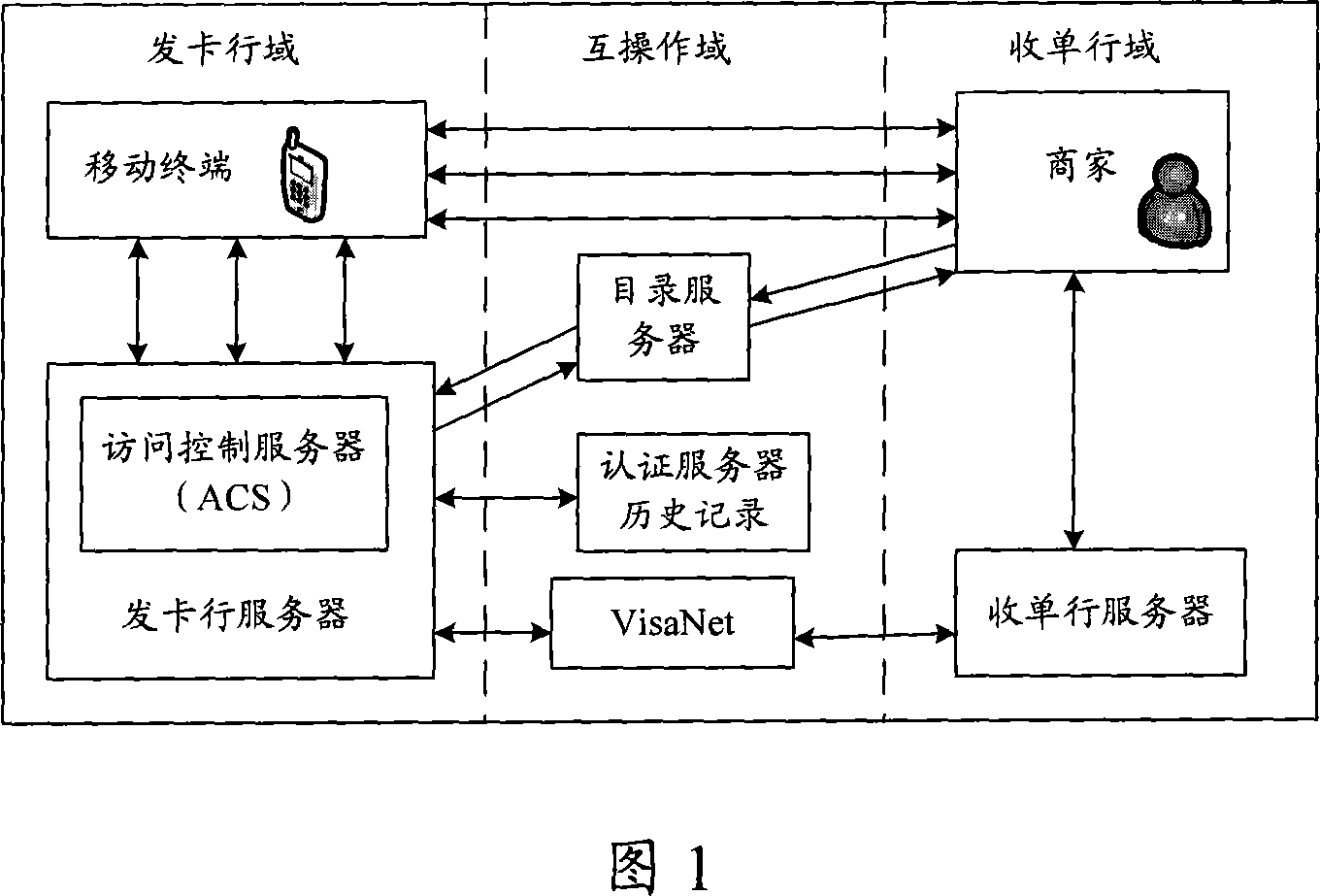

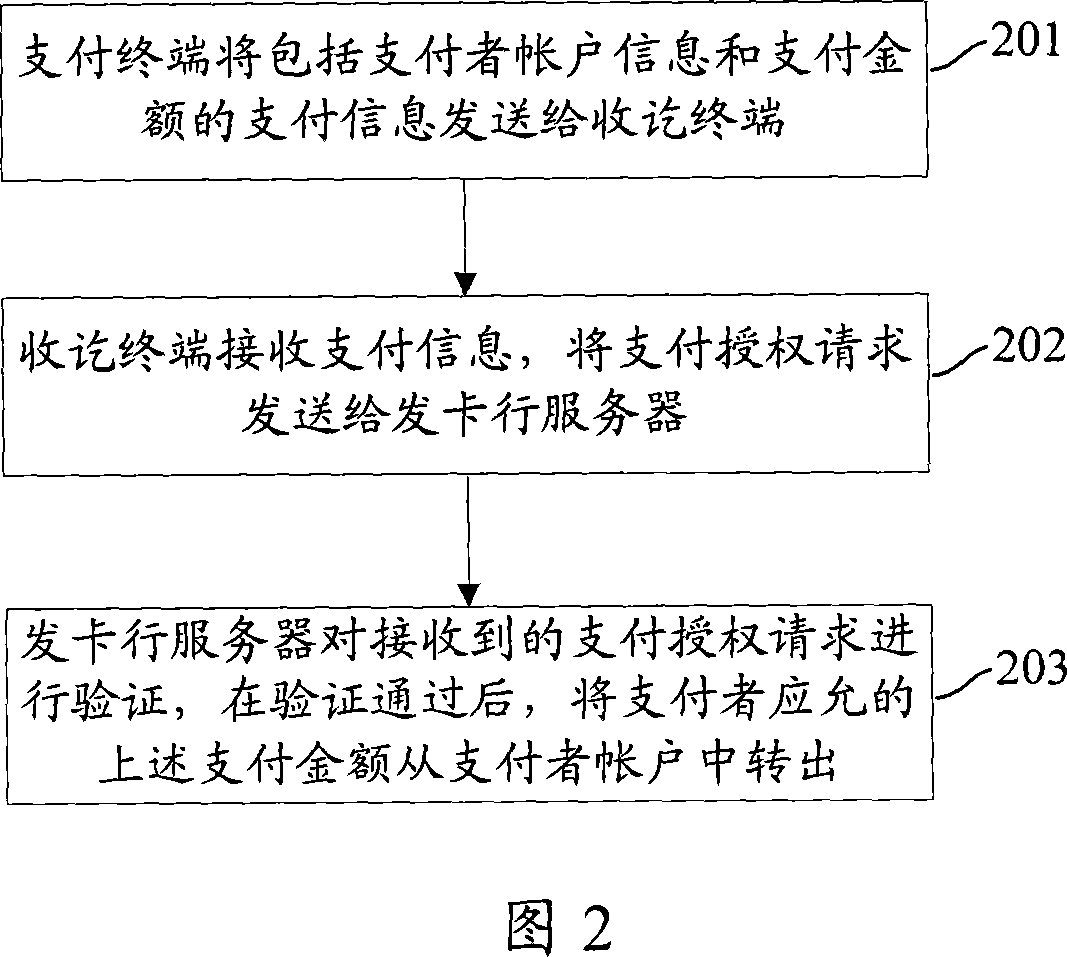

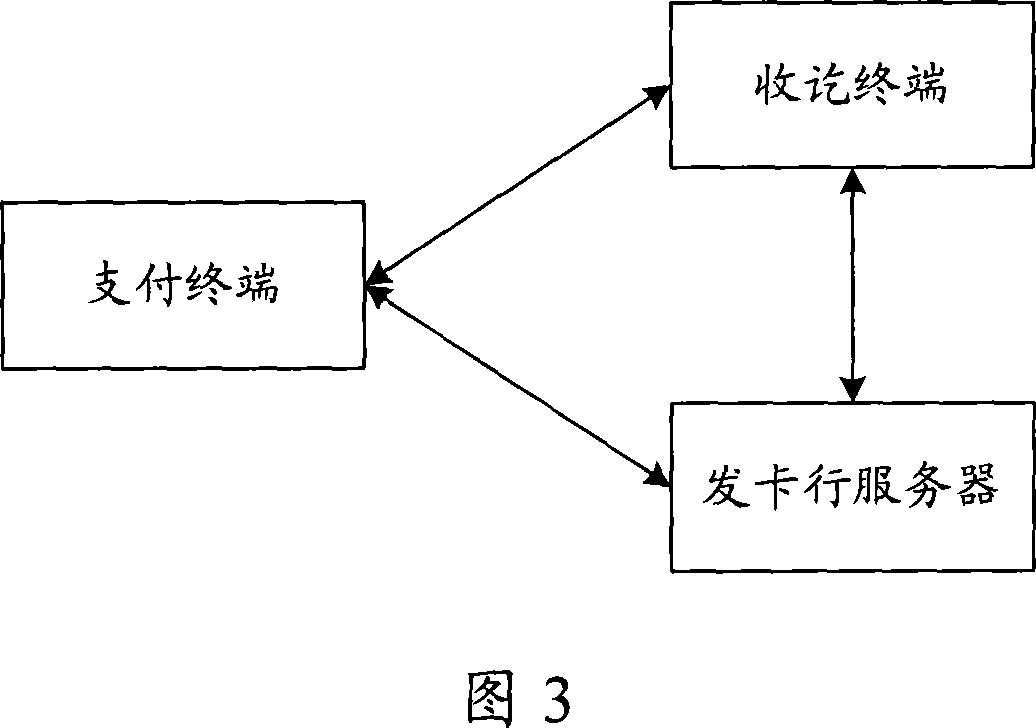

Method, system and mobile terminal for implementing electronic payment

InactiveCN101034449AReduce communication burdenReduce repetitionPayment architectureComputer scienceAuthorization

The invention provides a method of realizing of implementation of electronic payment, including: payment terminals sent account information of payer and payment information of the amount of payment to payment terminals of the receipter ;terminals of the receipter receive above information, the payment authorized request will be sent to issuers server, the request under the carry - information received and pay those accounts, including received information; issuers server verificates the received payment authorization request a, after the passage of the test, it will transfer account that payer who promised the stated amount. The implementation of this invention also provides a method based on the realization of electronic payment systems and mobile terminals. The technical implementation of the program provided by the invention will reduce repeated transmission of information during the whole process of payment, predigest payment streamline, and therefore reduce the burden of payment terminal communications, reduce communication costs and save transmission resources.

Owner:HUAZHONG UNIV OF SCI & TECH +1

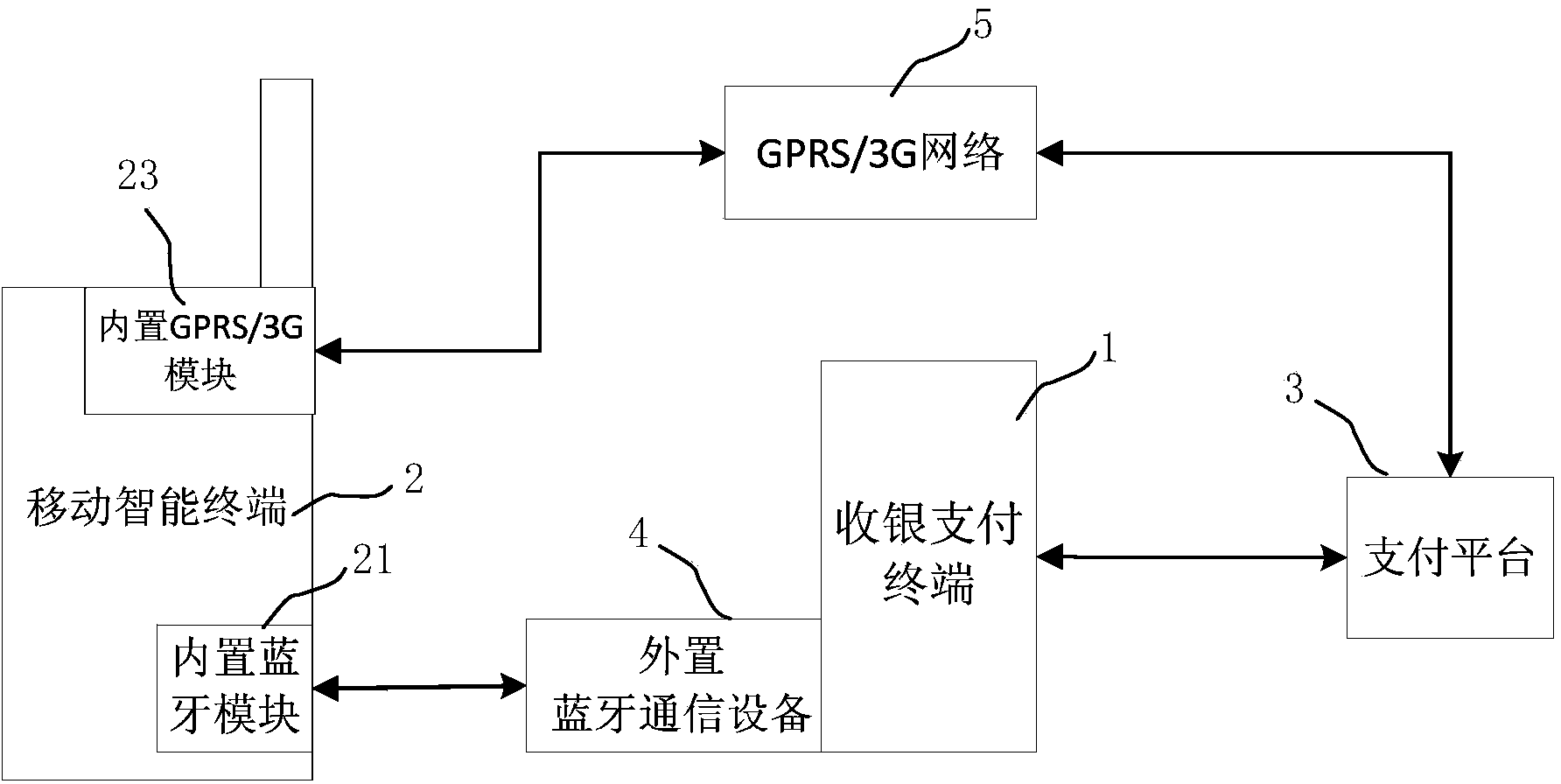

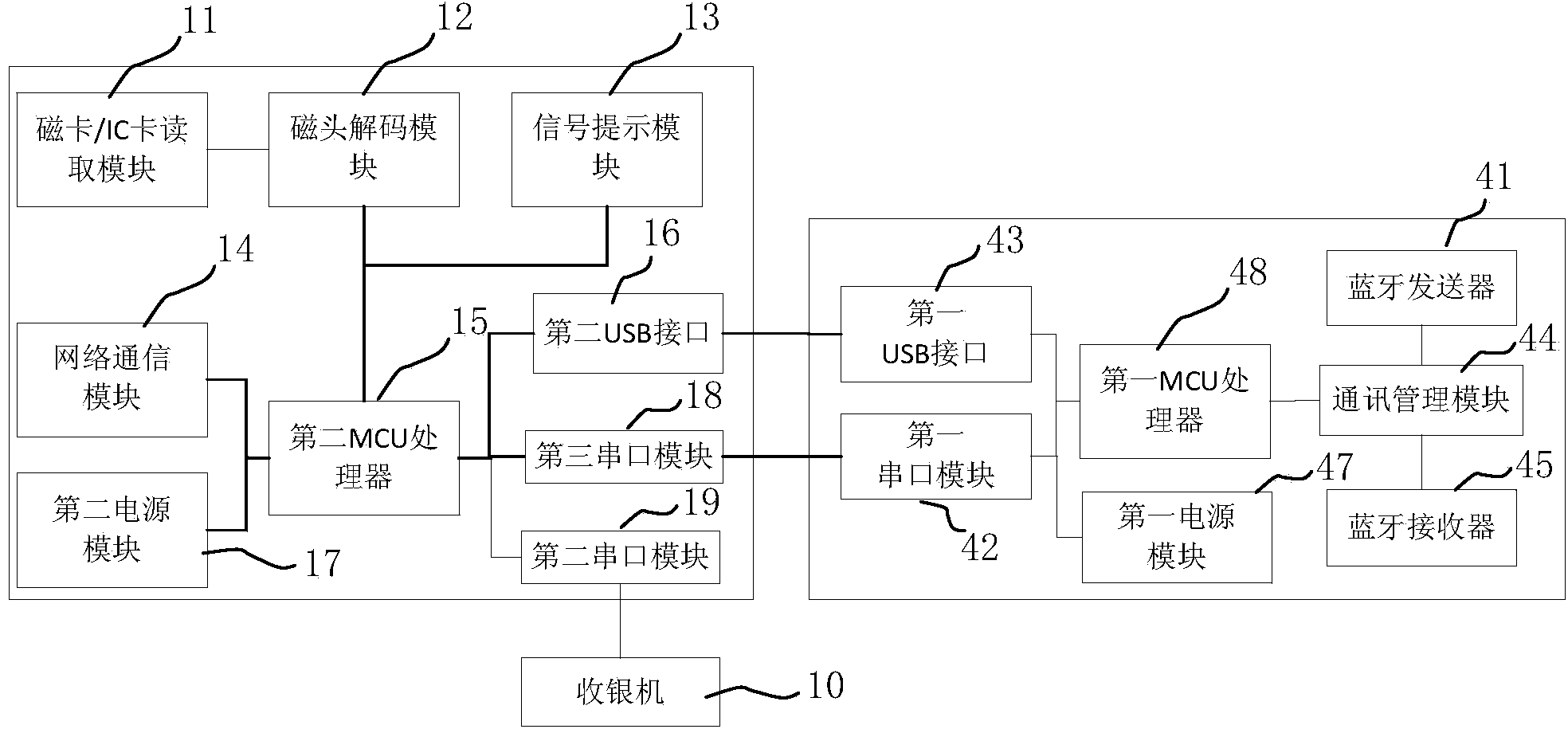

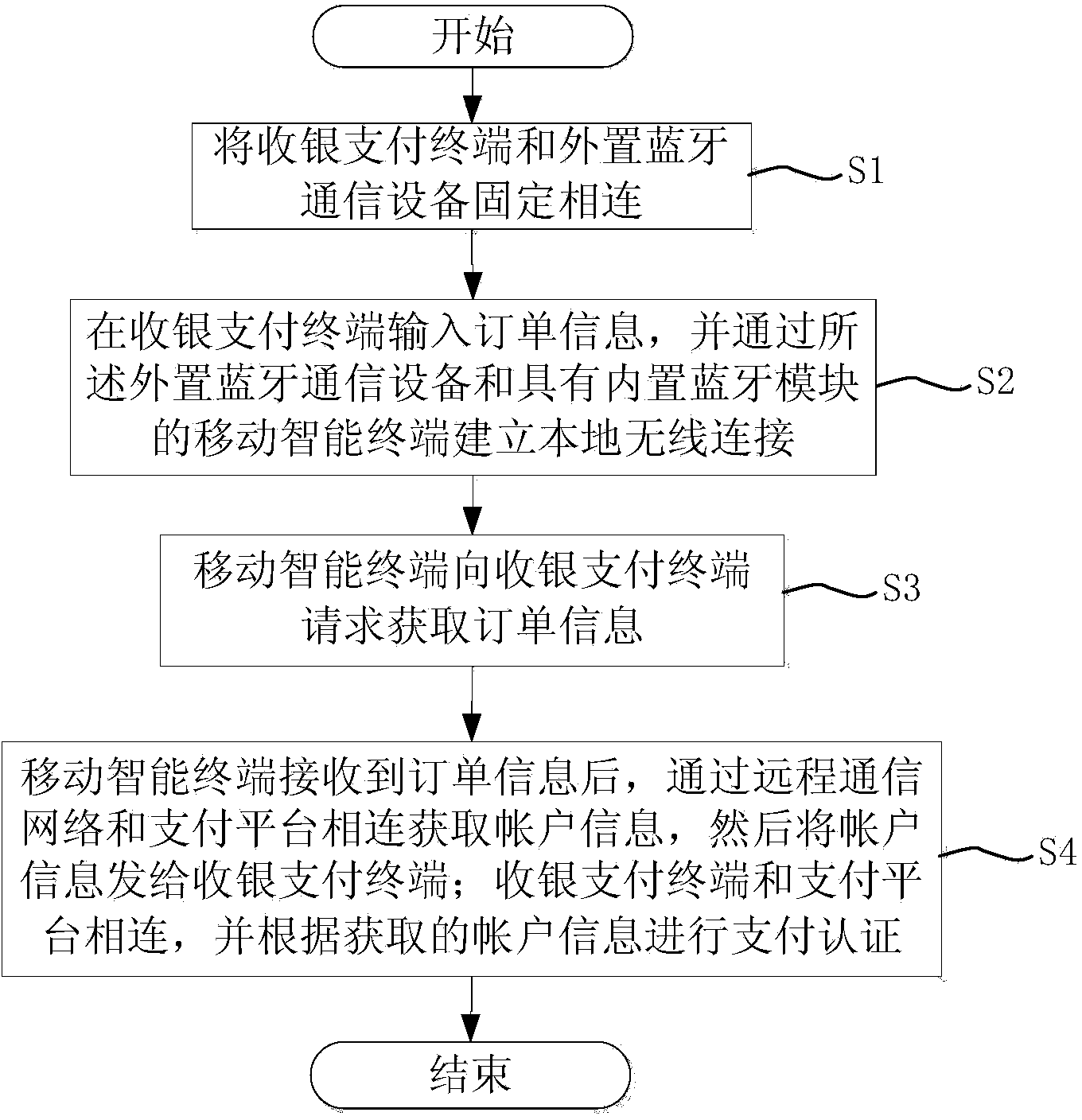

mobile intelligent terminal payment method and system based on low-power-consumption Bluetooth

ActiveCN103824185AImprove payment experienceImprove conveniencePayment architectureAuthorizationLow power dissipation

The invention discloses a mobile intelligent terminal payment method and system based on low-power-consumption Bluetooth. The method comprises the following steps: (a) connecting a cashier payment terminal with external Bluetooth communication equipment; (b) inputting order information into the cashier payment terminal, and establishing local wireless connection through the external Bluetooth communication equipment and a mobile intelligent terminal; (c) requesting for the cashier payment terminal to obtain the order information by the mobile intelligent terminal; and (d) connecting the mobile intelligent terminal with a payment platform to acquire account information after the order information is received, transmitting the account information to the cashier payment terminal, wherein the cashier payment terminal is connected with the payment platform, and performing payment authorization according to the acquired account information. According to the mobile intelligent terminal payment method and system based on low-power-consumption Bluetooth provided by the invention, a cashier system is combined with online payment of the mobile intelligent terminal, and the conventional cashier system is not needed to be transformed, so that the convenience and intelligent selection of transaction and payment are greatly improved.

Owner:平安付科技服务有限公司

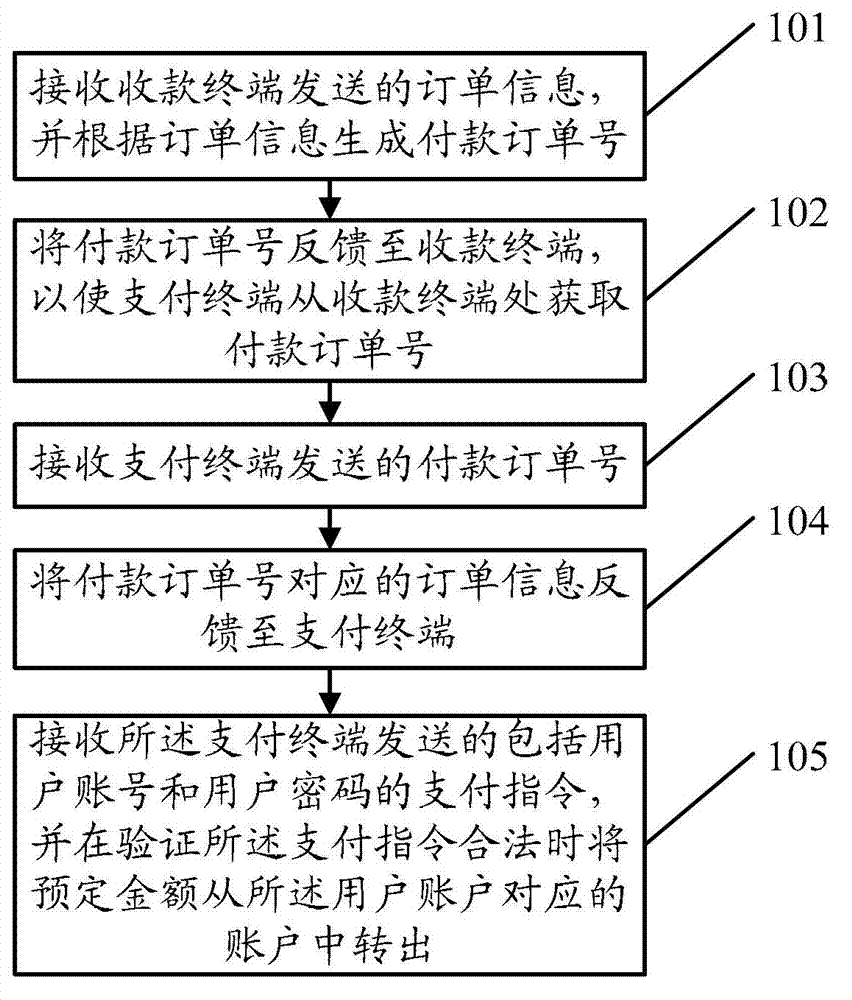

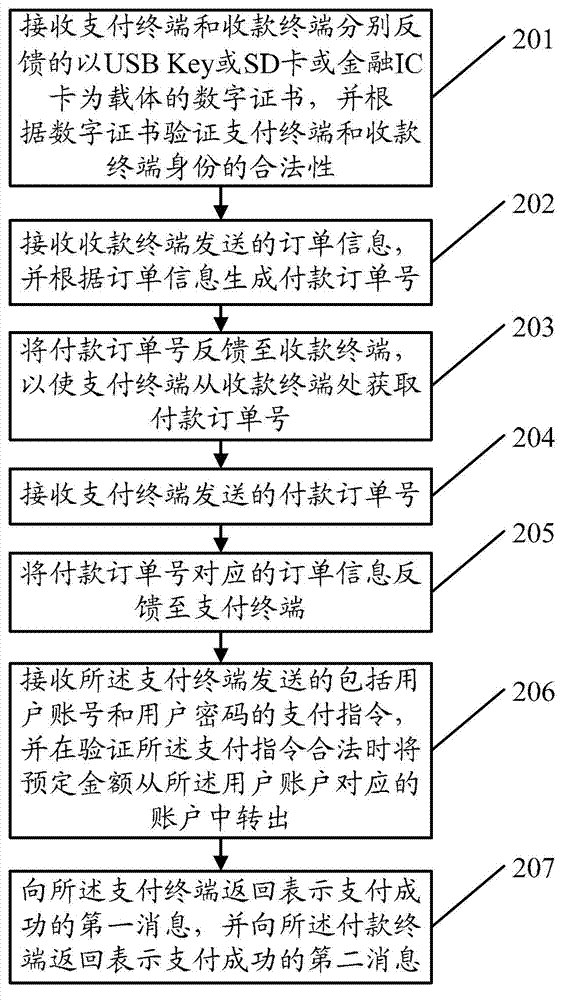

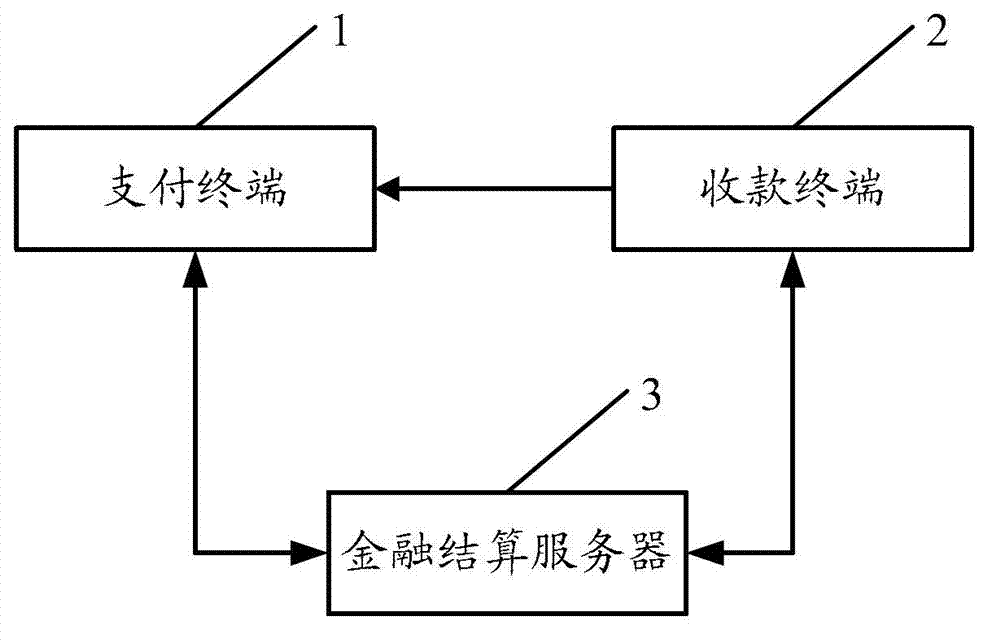

Electronic payment method, relevant device and system

The invention provides an electronic payment method, a relevant device and a system. An embodiment of the invention discloses the electronic payment method. The method includes that order information sent by a collection terminal is received, and a payment order number is generated according to the order information; the payment order number is returned to the collection terminal, and the payment terminal obtains the payment order number from the collection terminal; the payment order number sent by the payment terminal is received; order information corresponding to the payment order number is returned to the payment terminal; and payment commands including a user's account and user's passwords sent by the payment terminal are received, and when the payment commands are verified to be legal, preset money is transferred out from an account corresponding to the user's account. By means of the electronic payment method, the relevant device and the system, a double-channel examining and verifying mechanism is adopted, and transaction safety is improved.

Owner:HUAWEI TECH CO LTD

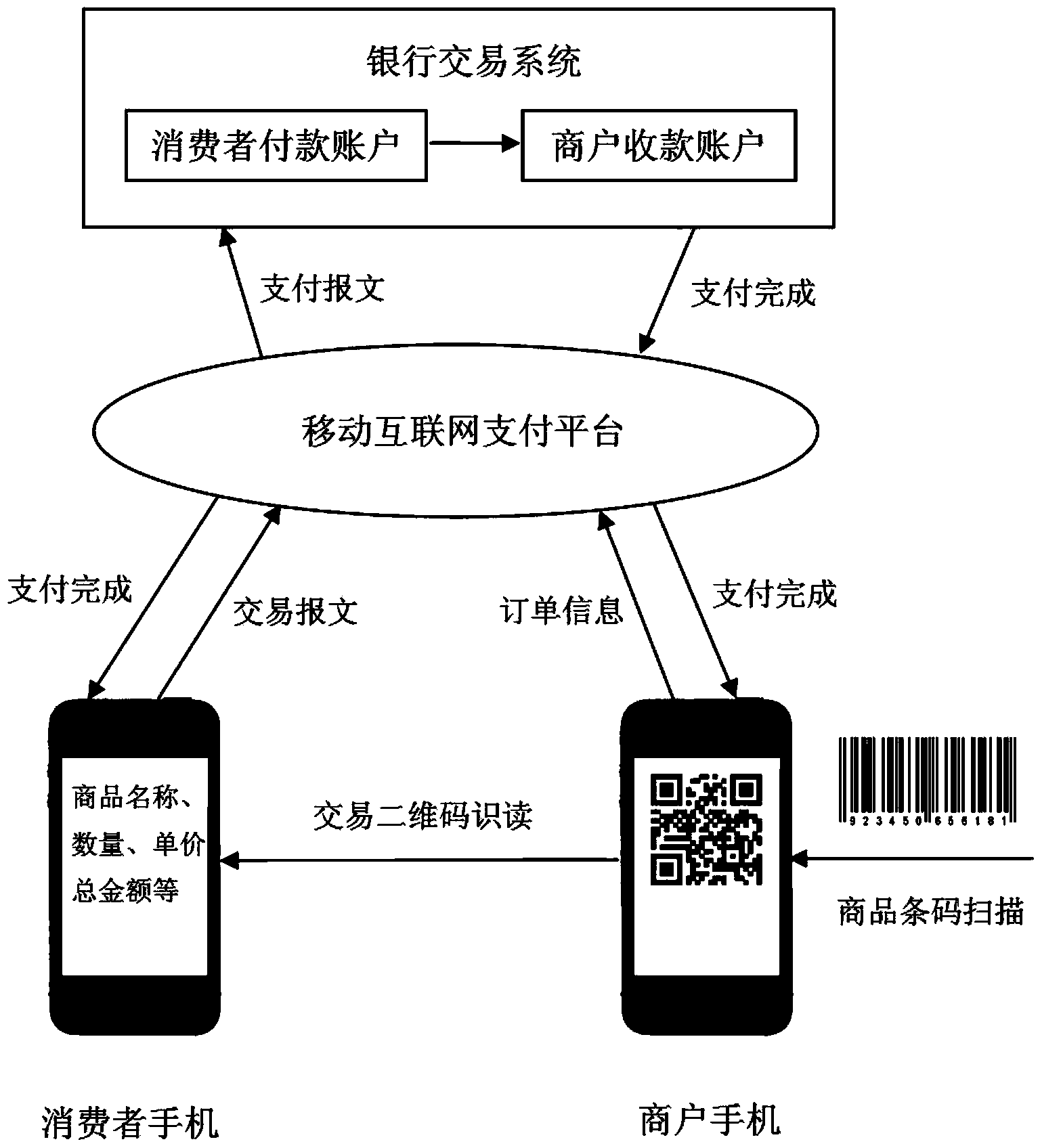

Mobile payment method for field shopping

InactiveCN103854173ASolve the problem of being easily stolenEliminate human input errorsProtocol authorisationThe InternetComputer science

Owner:UNISPLENDOUR CO LTD +2

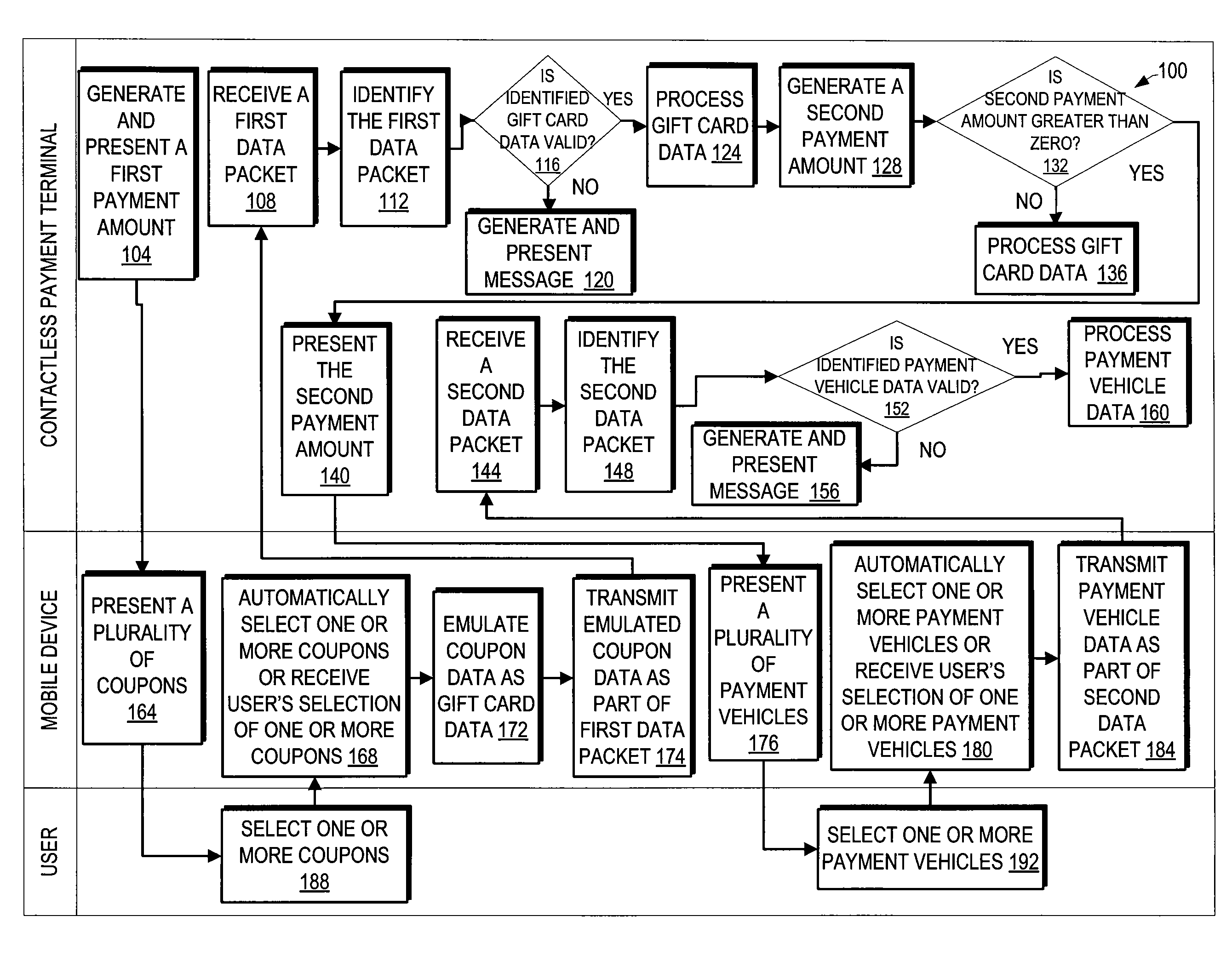

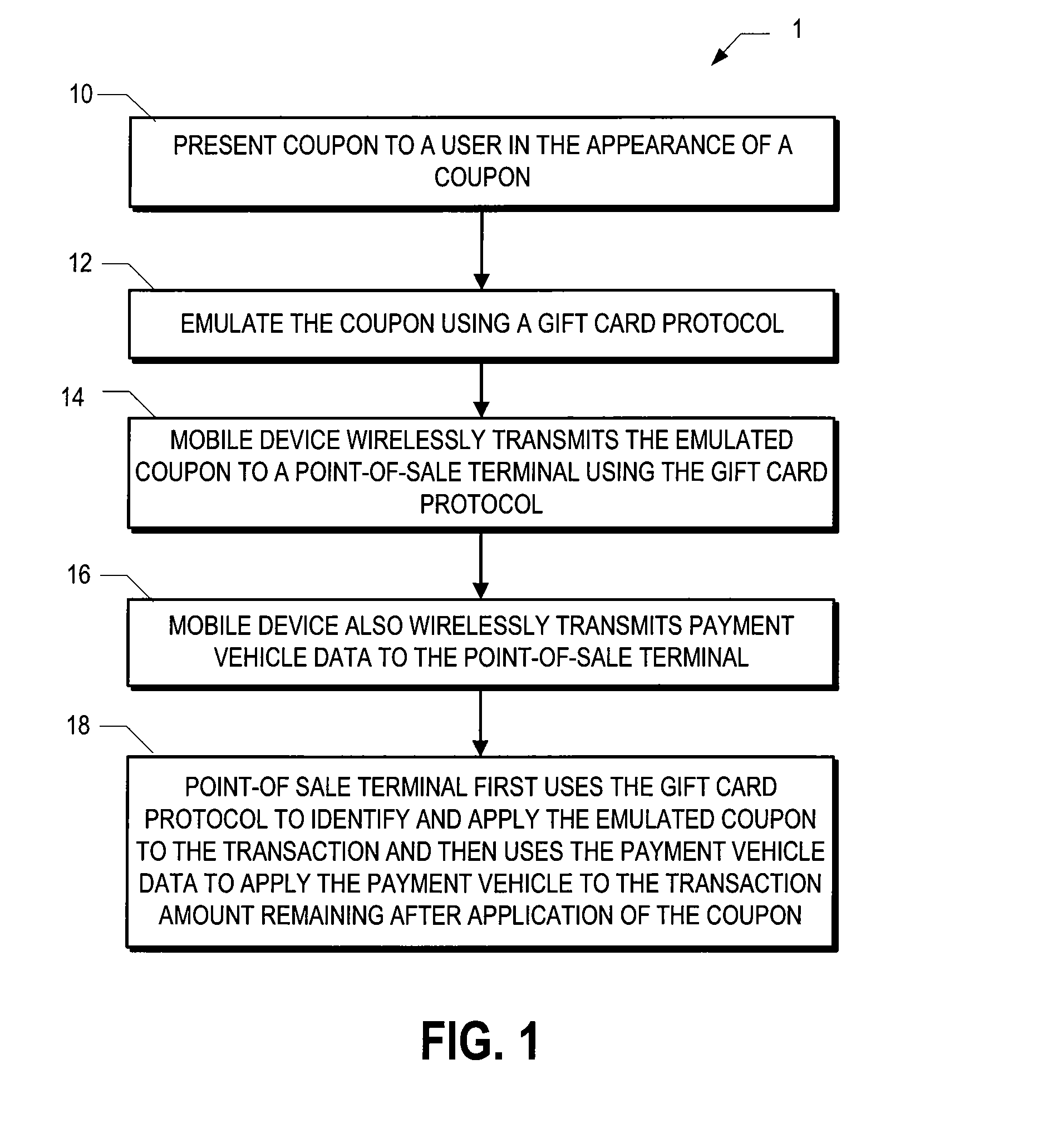

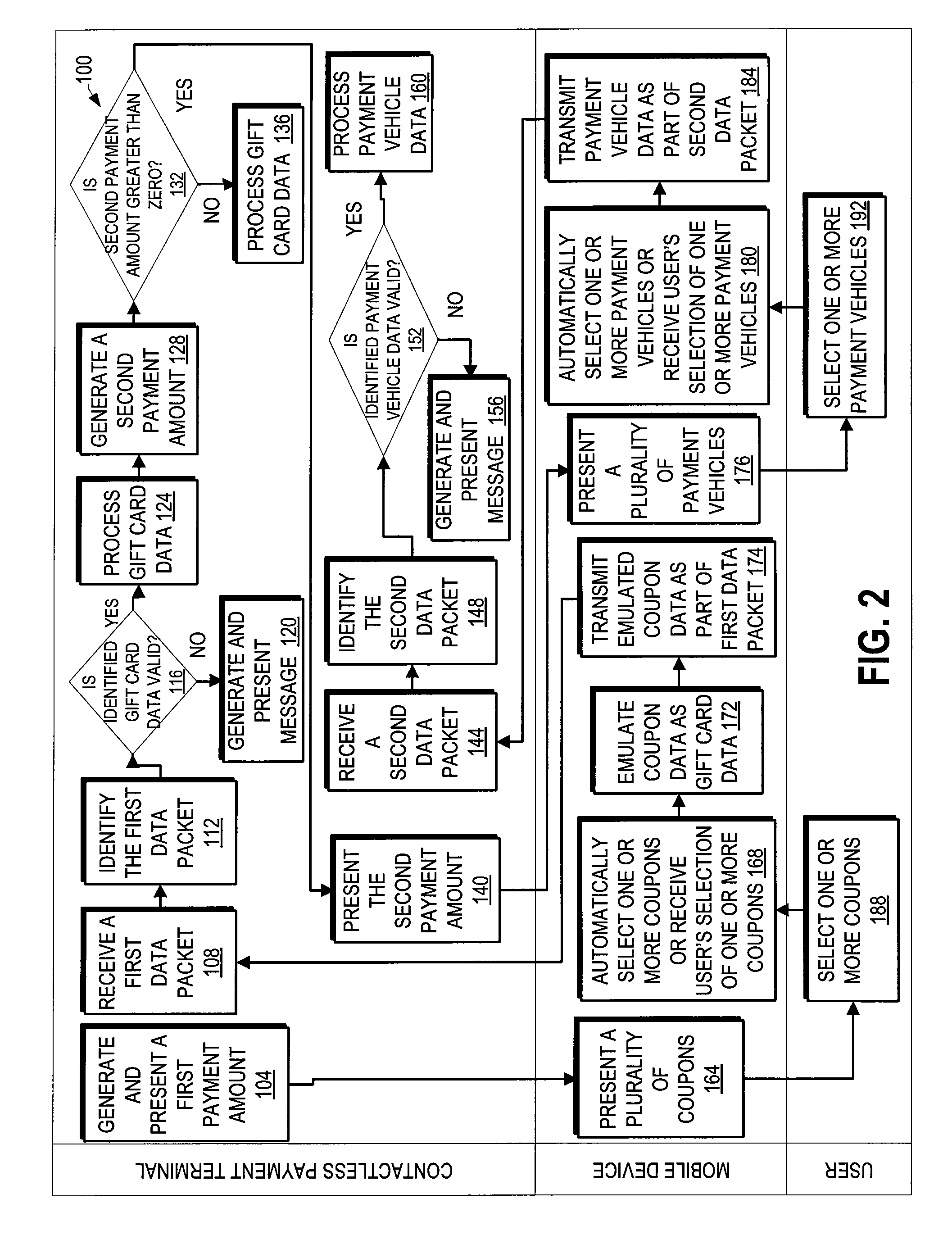

Payment using an emulated electronic coupon in a contactless payment environment

Embodiments of the invention are directed to apparatus, methods, and computer program products for making a payment at a contactless payment terminal using an electronic coupon emulated as an electronic gift card. In one embodiment, a mobile device emulates electronic coupon data associated with an electronic coupon as electronic gift card data, and transmits this emulated coupon data to a contactless payment terminal that has the ability to read and processes electronic gift card data. Therefore, the invention may permit a user to make a payment using an electronic coupon at a contactless payment terminal that is not configured to read the native data format of the electronic coupon.

Owner:BANK OF AMERICA CORP

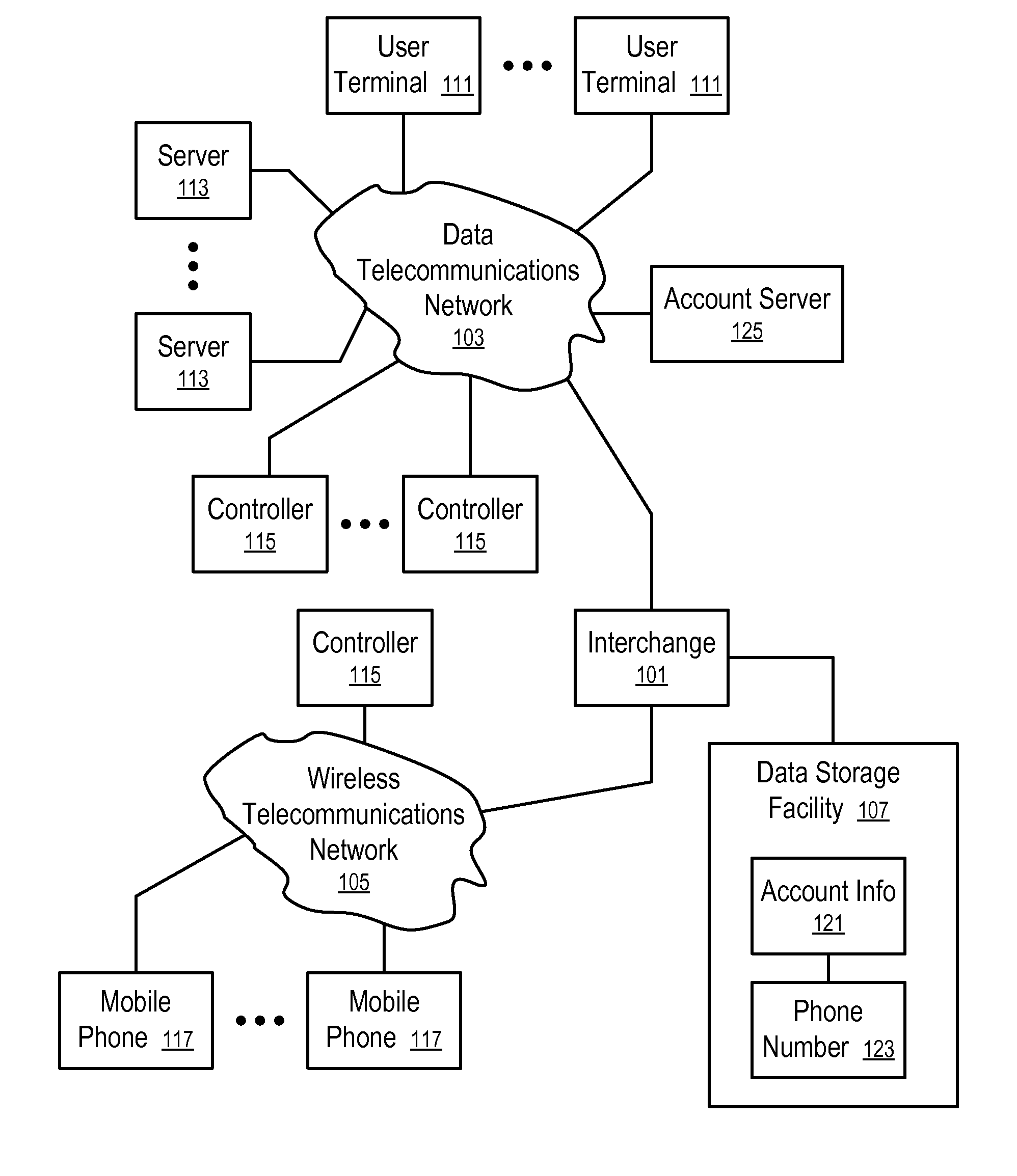

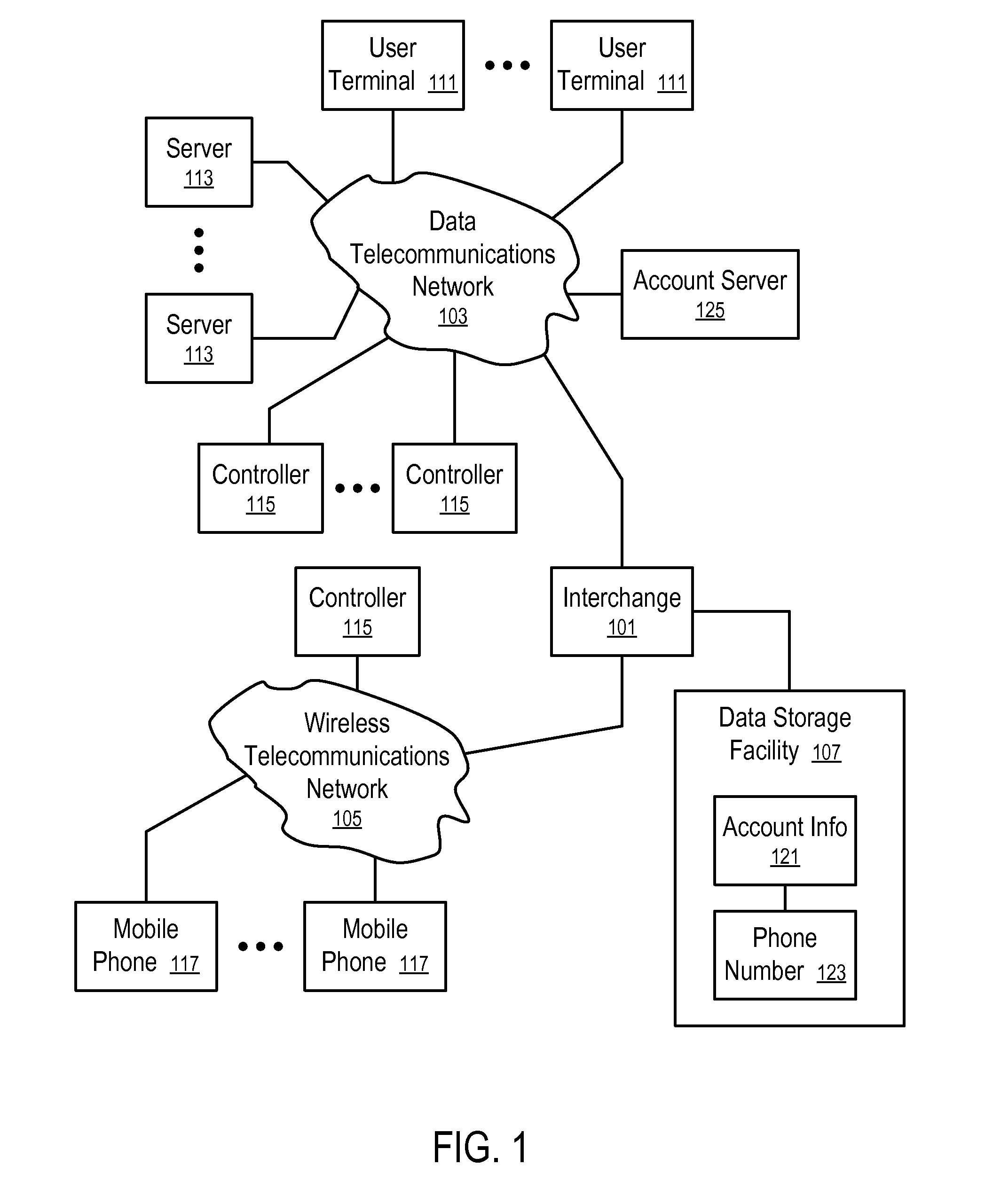

Systems and Methods to Process Payments

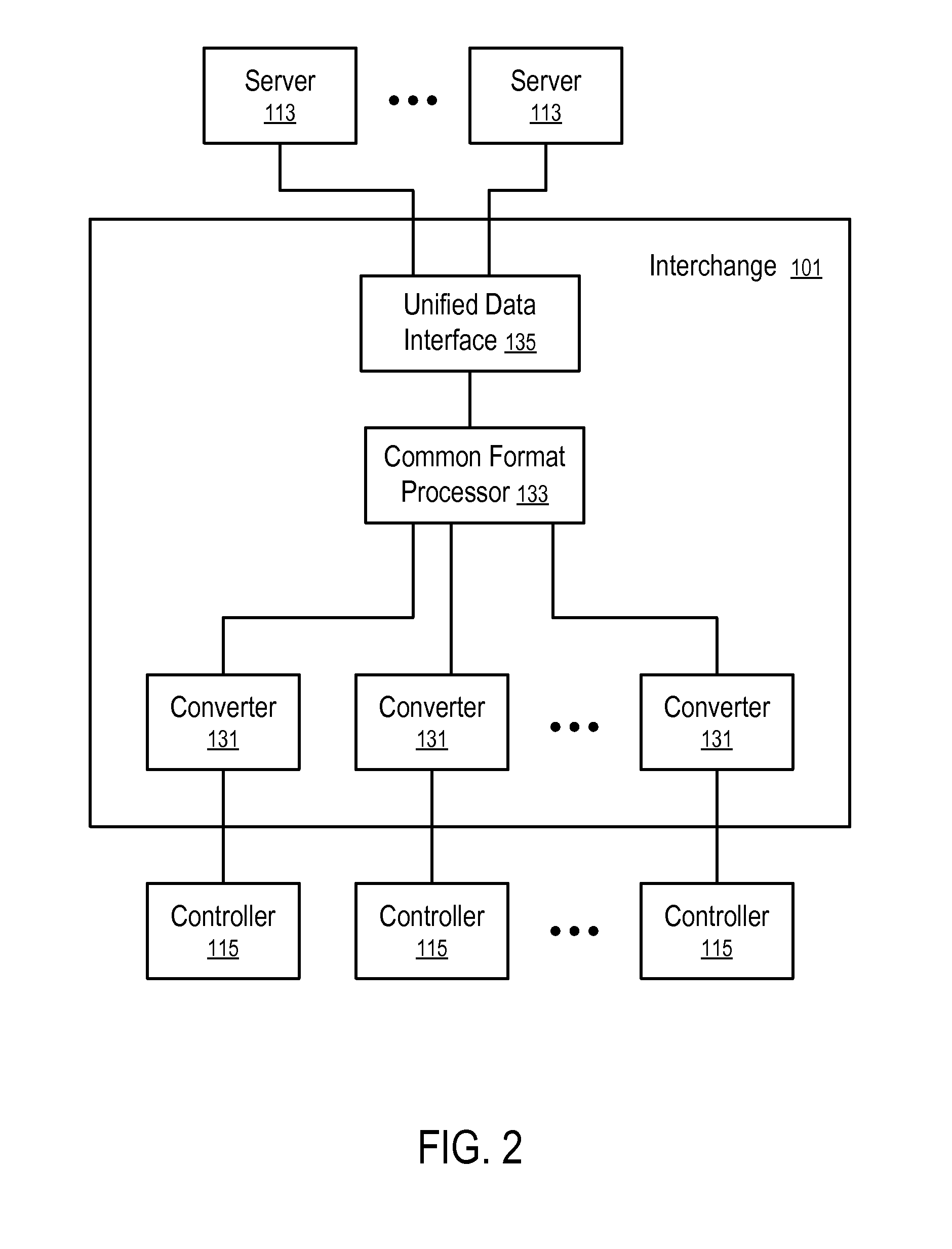

Systems and methods are provided to facilitate online transactions via mobile communications. In one aspect, a system includes a data storage facility and an interchange coupled with the data storage facility that stores data associating a phone number with an account, such as a balance of the account, identification information of a plurality of funding sources, and security data for authentication. The interchange includes a common format processor and a plurality of converters to interface with a plurality of different controllers of mobile communications. The converters are configured to communicate with the controllers in different formats and with the common format processor in a common format, to facilitate authentication of the payment requests received from various payment terminals. The requests are authenticated via both the security data and communications with a mobile phone having the phone number. After the authentication, the payments are effected using the account.

Owner:BOKU

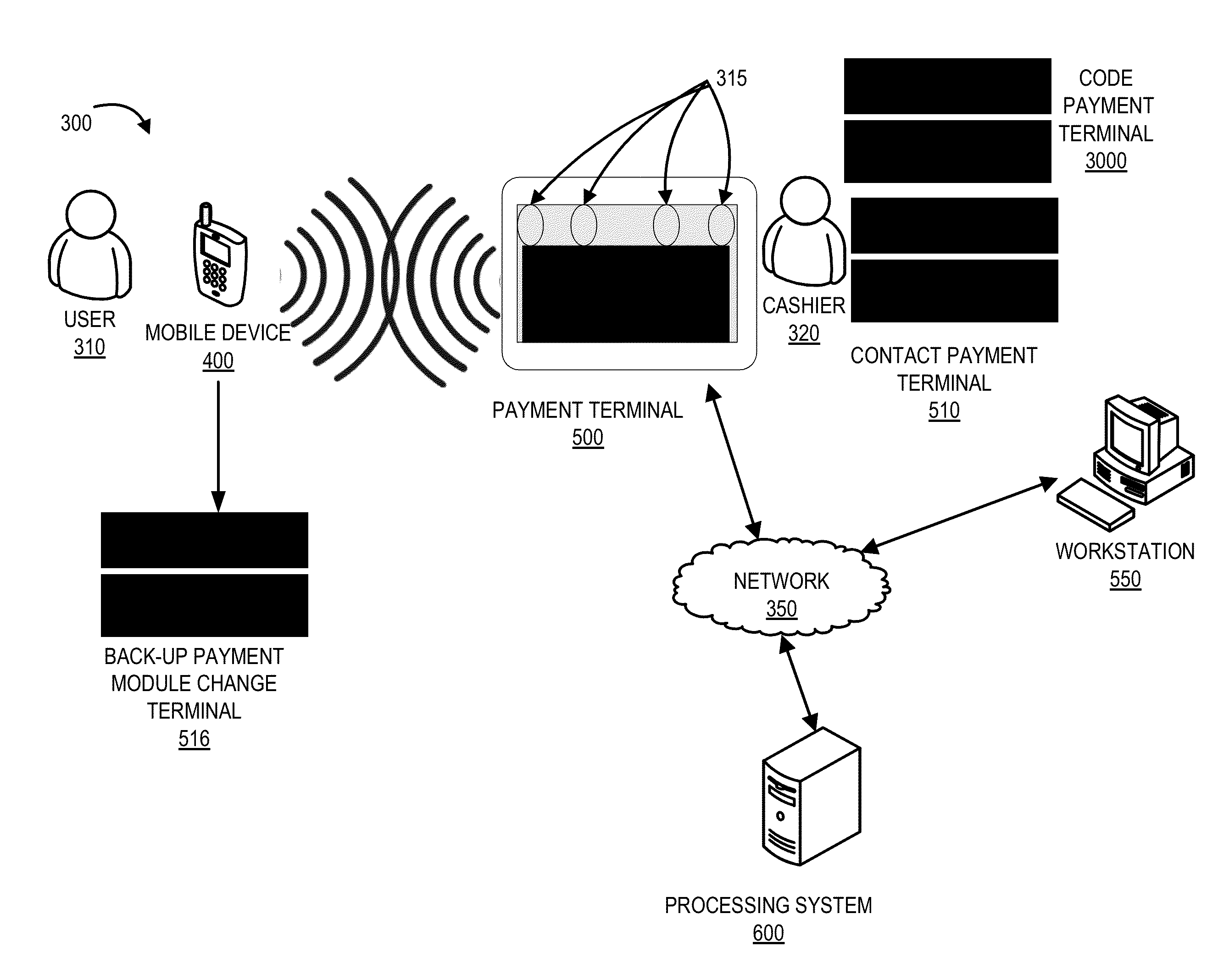

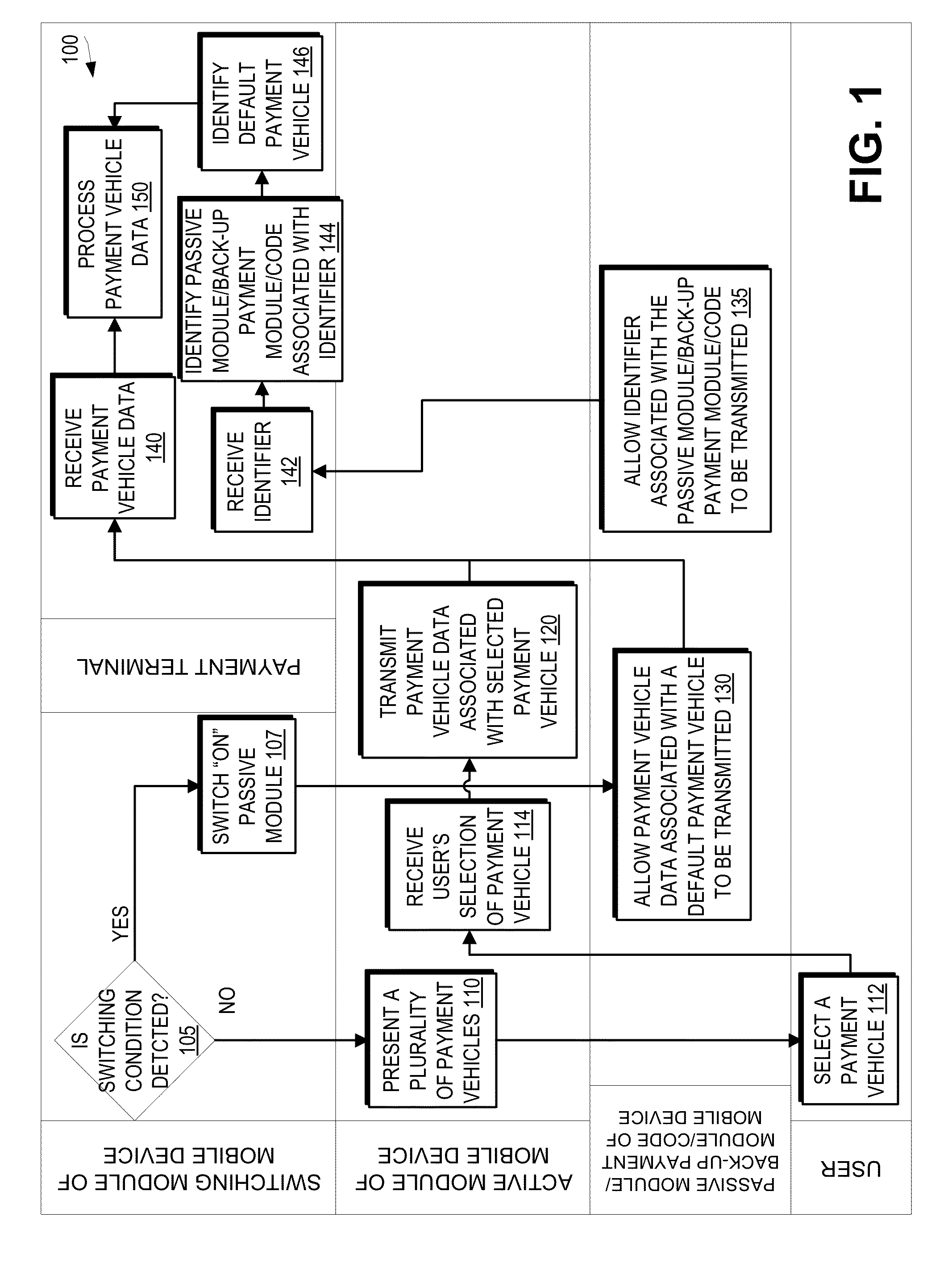

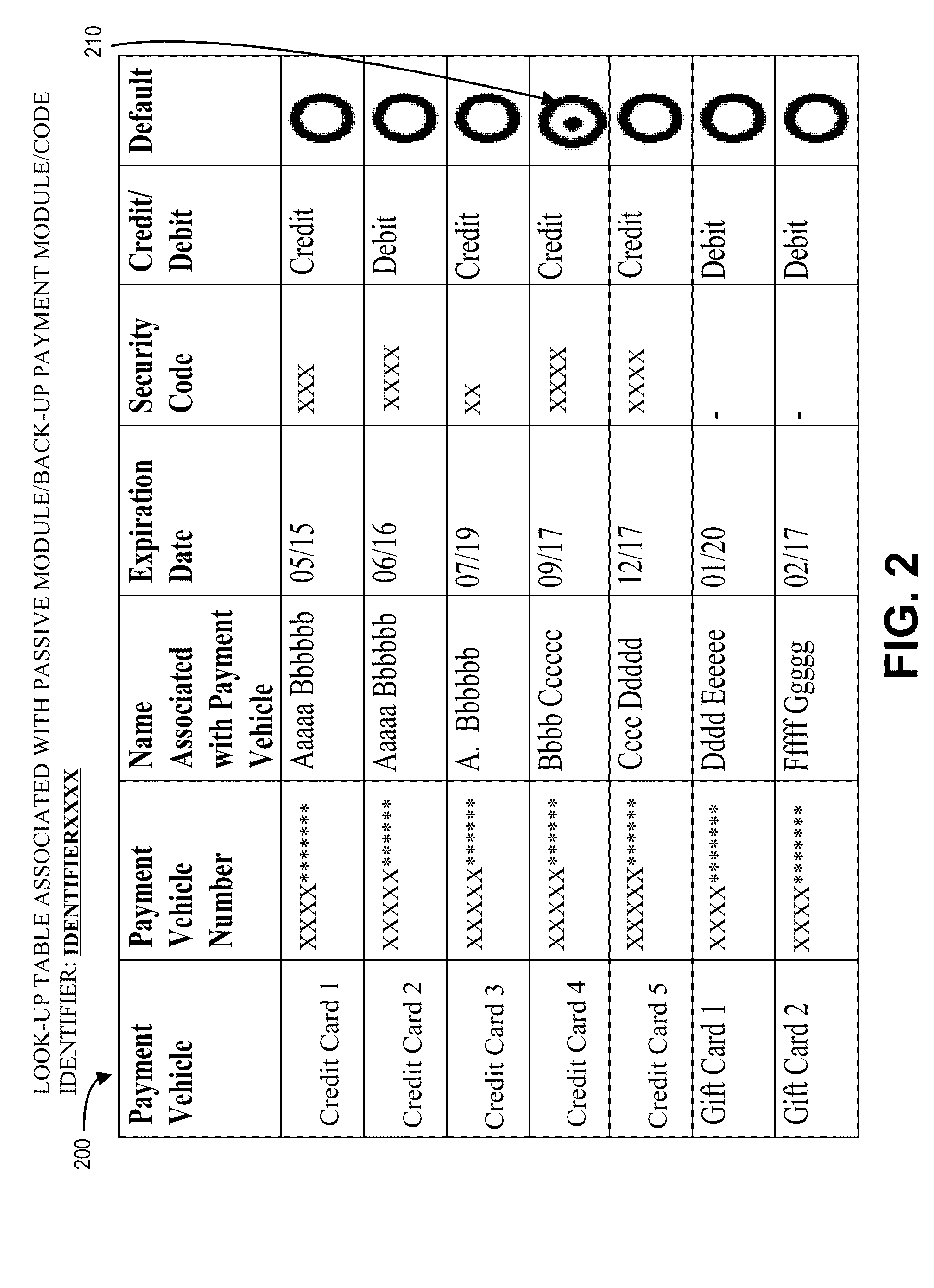

Mobile apparatus with back-up payment system

Embodiments of the invention are directed to apparatus, methods, and computer program products for allowing a user to make a payment at a payment terminal via a mobile device via a back-up payment module that is attached to the mobile device. In some embodiments, the back-up payment module allows a user to make a payment at a payment terminal by establishing physical contact between the back-up payment module and the payment terminal. In some embodiments, the back-up payment module allows a user to make a payment at a payment terminal when one or more other methods of making a payment via a mobile device are unavailable.

Owner:BANK OF AMERICA CORP

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com