Patents

Literature

3632 results about "Point of sale" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

The point of sale (POS) or point of purchase (POP) is the time and place where a retail transaction is completed. At the point of sale, the merchant calculates the amount owed by the customer, indicates that amount, may prepare an invoice for the customer (which may be a cash register printout), and indicates the options for the customer to make payment. It is also the point at which a customer makes a payment to the merchant in exchange for goods or after provision of a service. After receiving payment, the merchant may issue a receipt for the transaction, which is usually printed but can also be dispensed with or sent electronically.

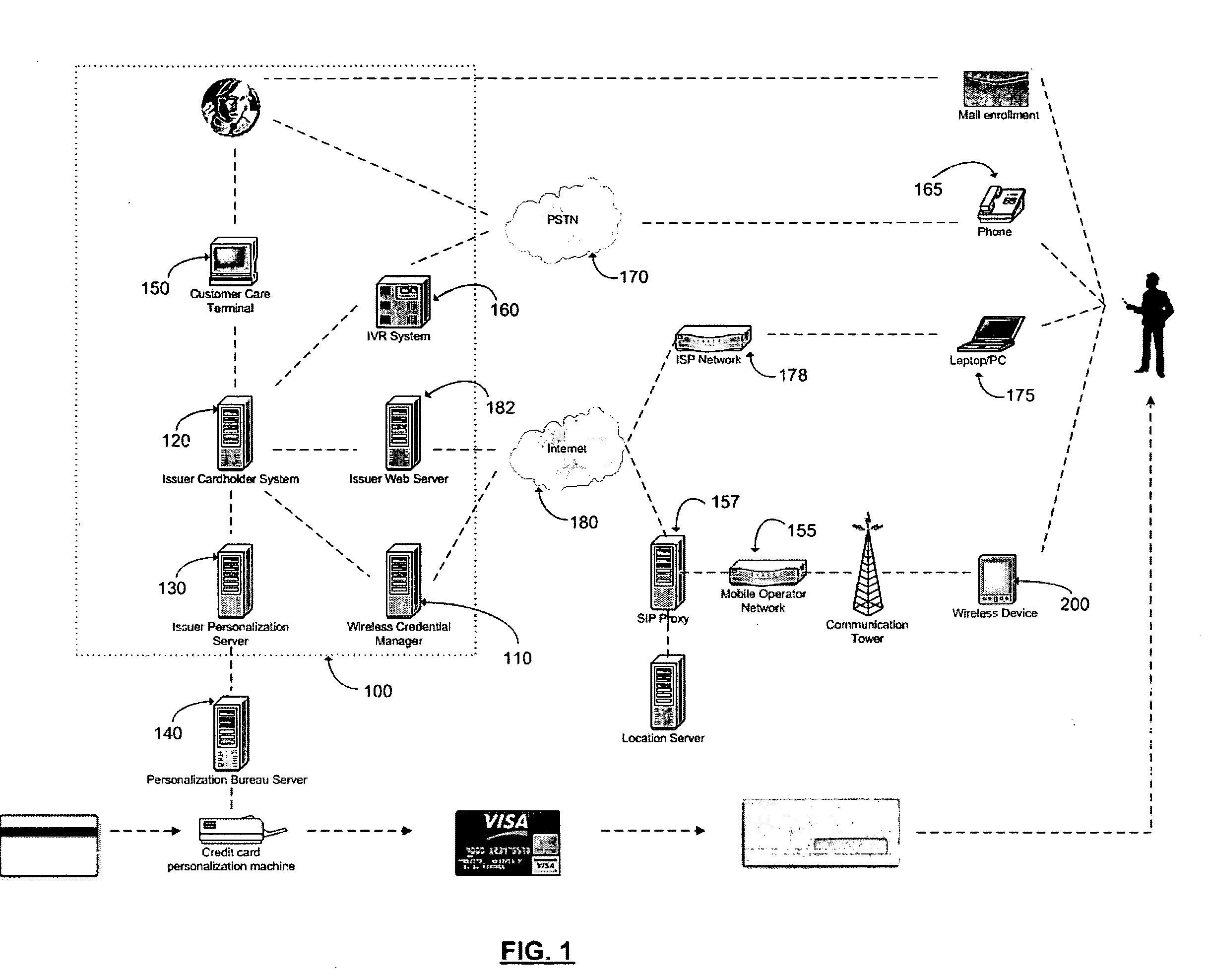

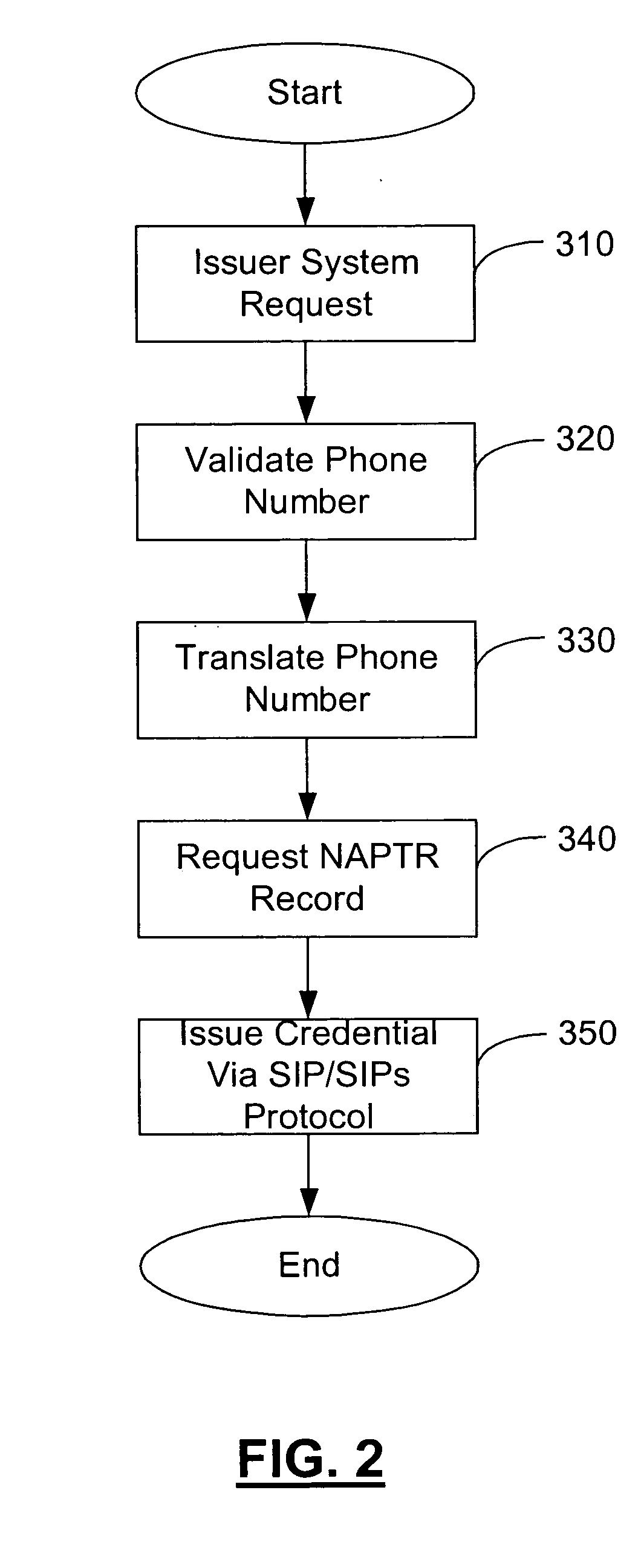

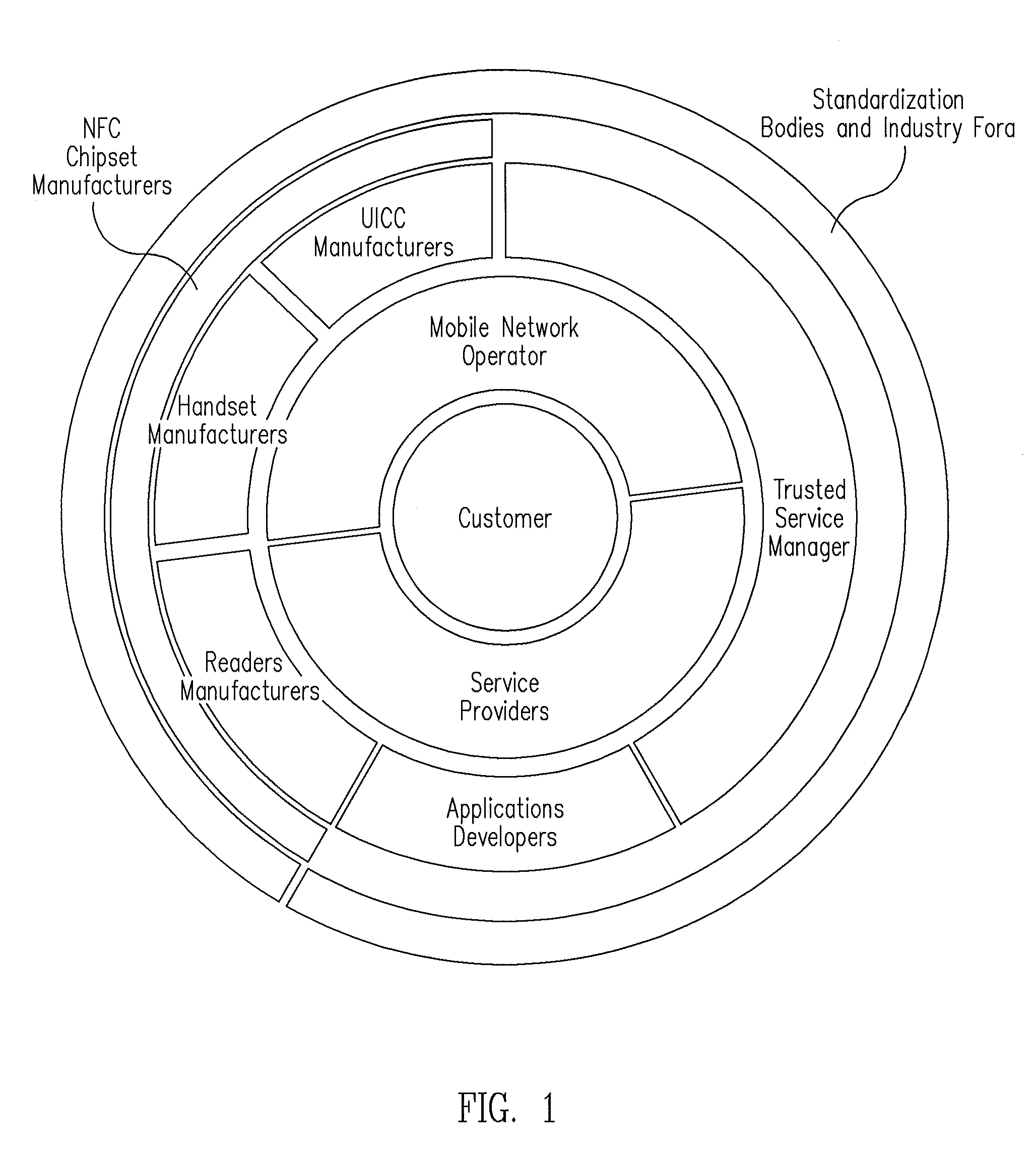

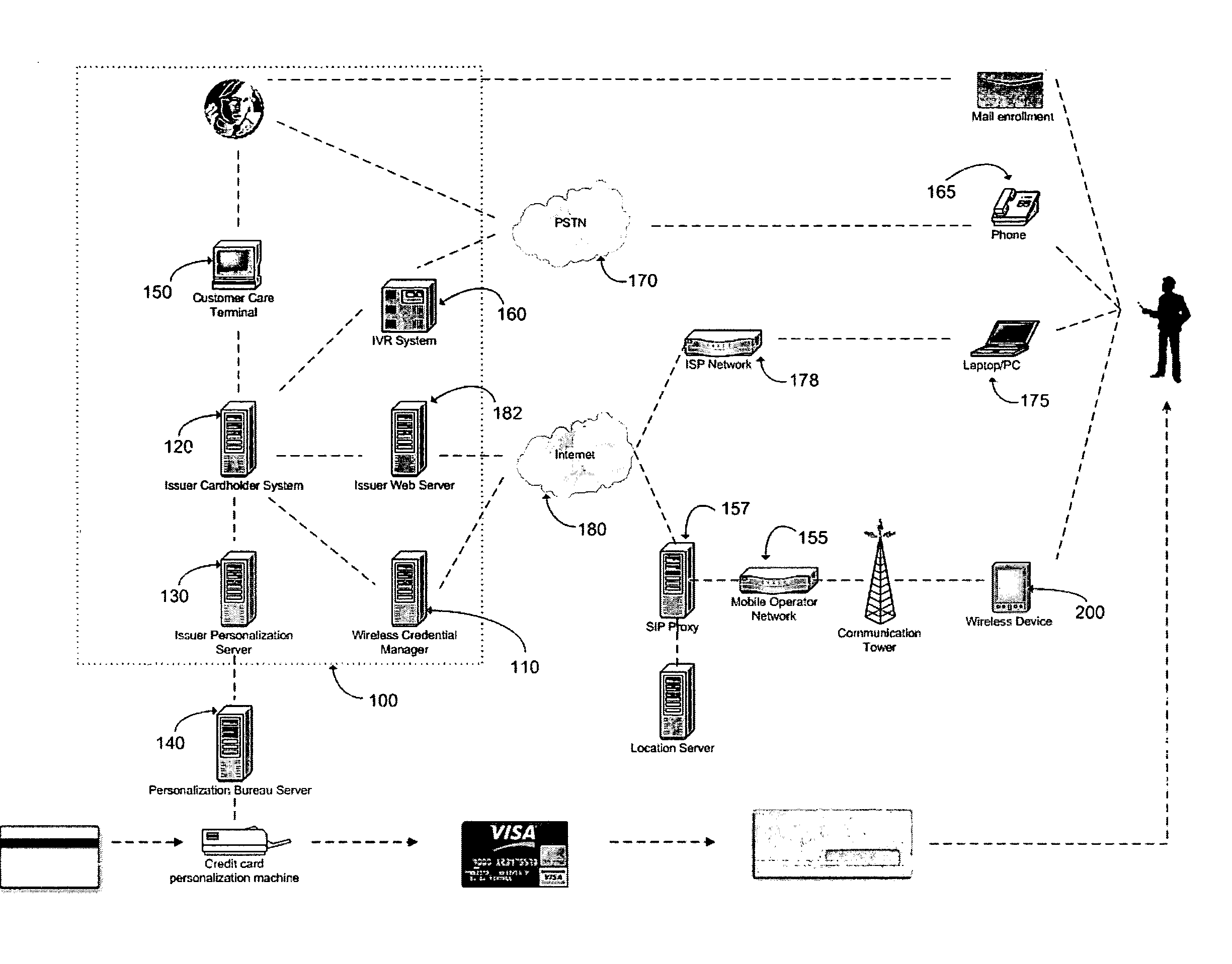

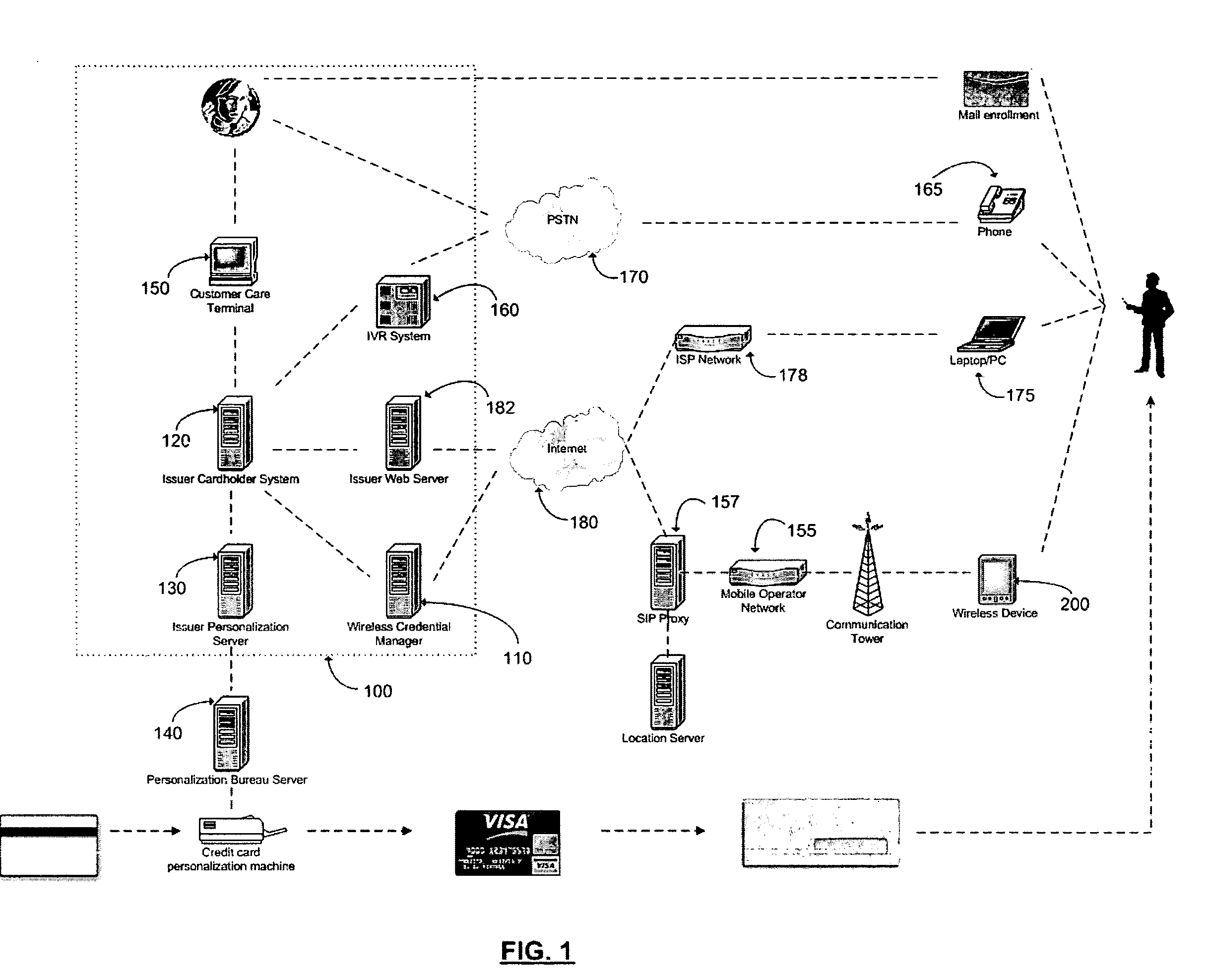

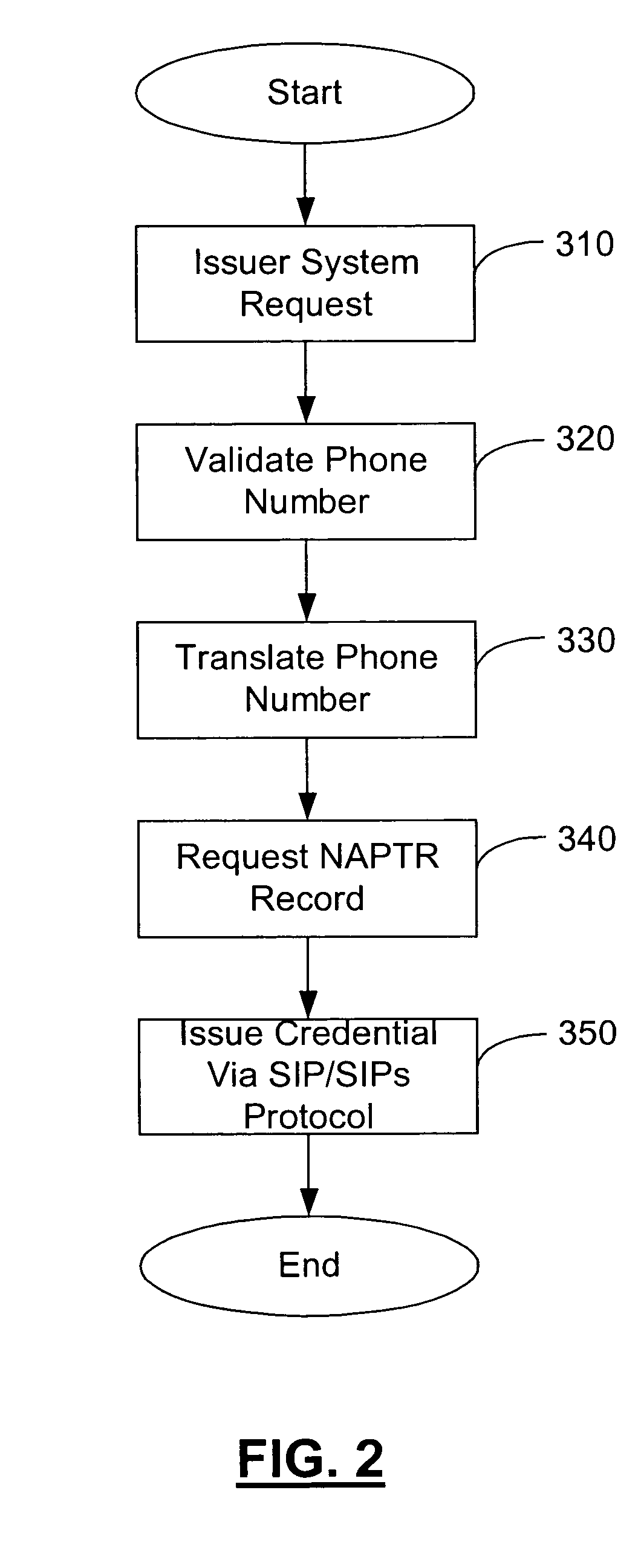

Method and apparatus for managing credentials through a wireless network

ActiveUS20060165060A1Convenient and efficient and secure distributionNear-field in RFIDData switching by path configurationCredit cardWireless mesh network

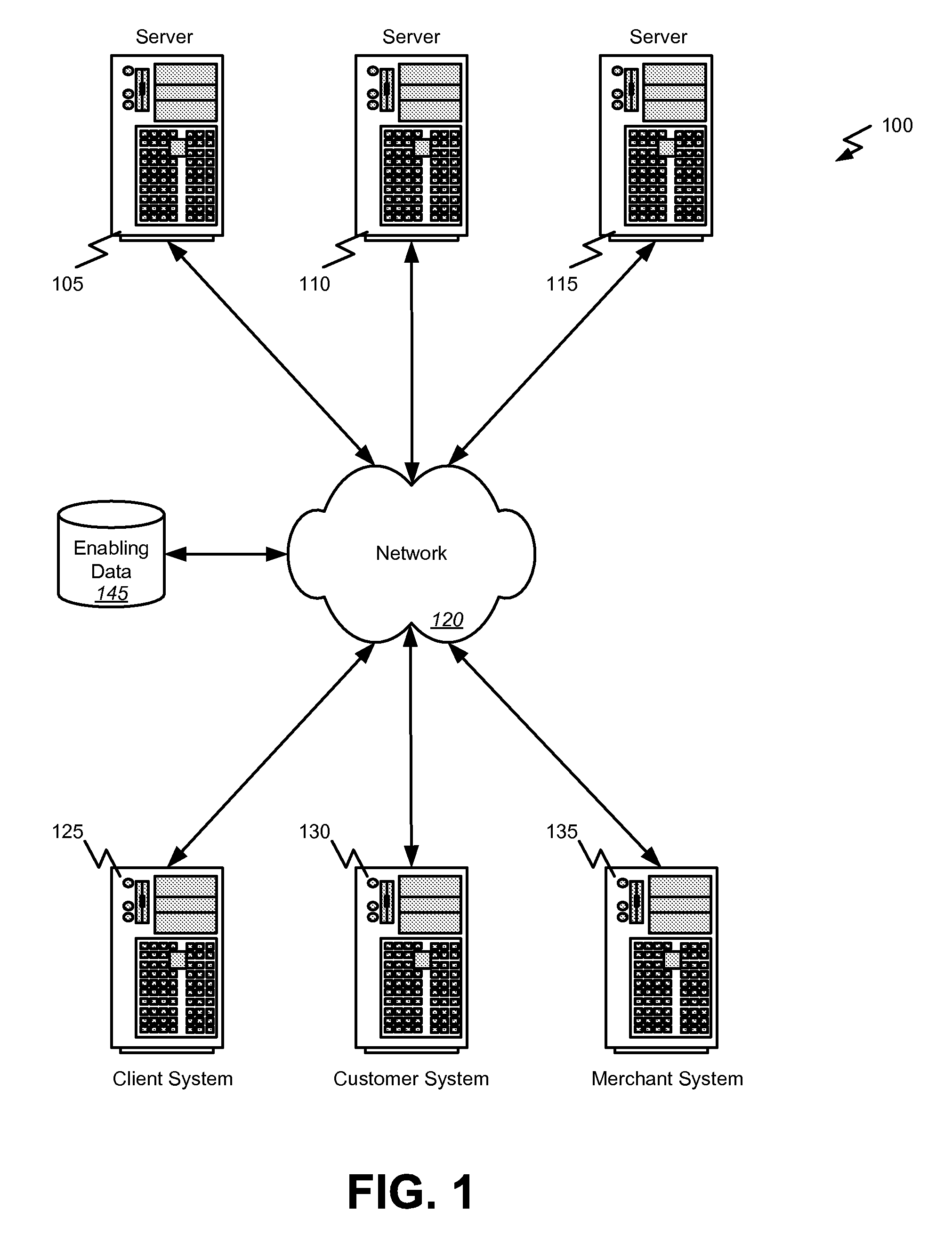

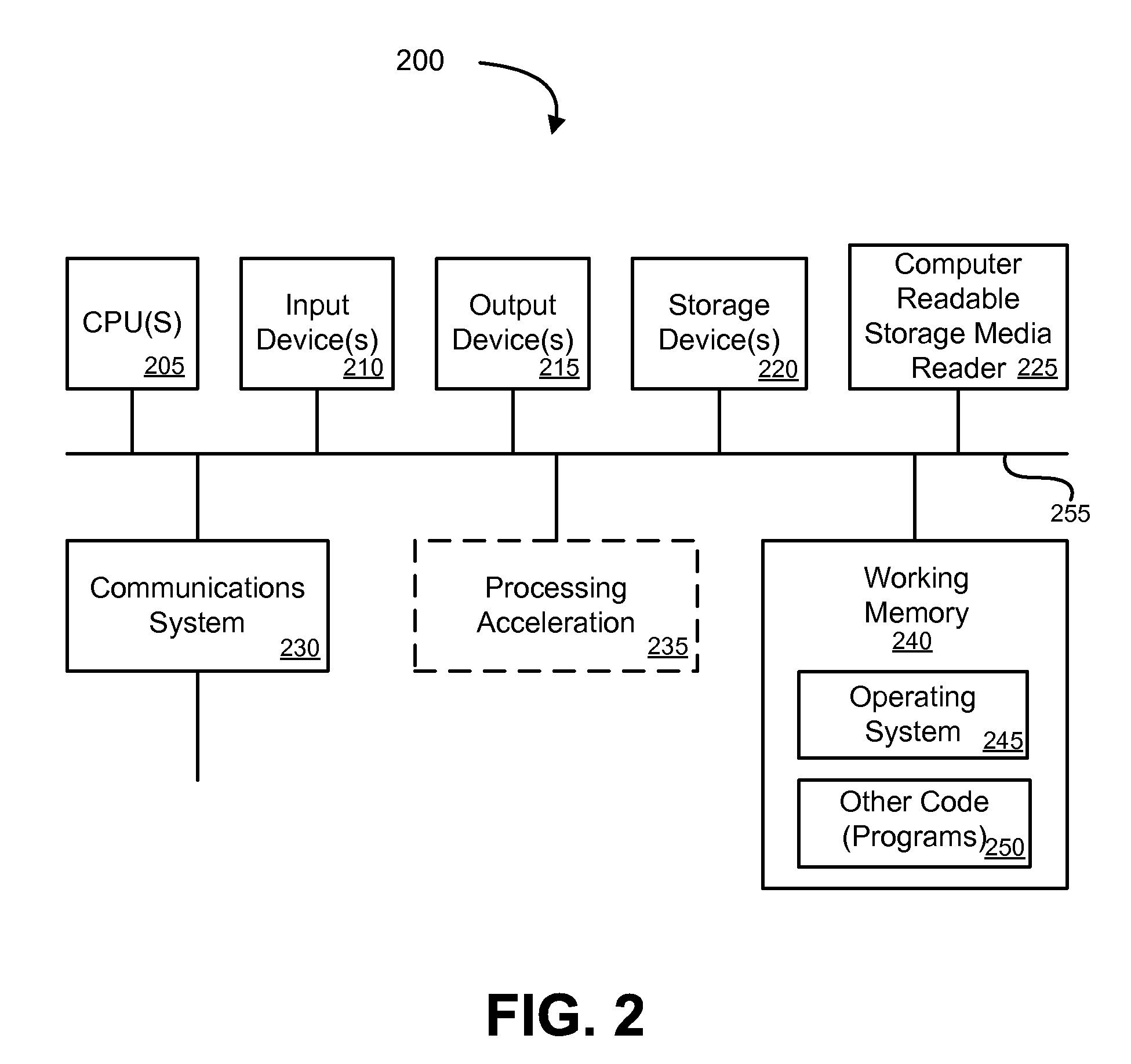

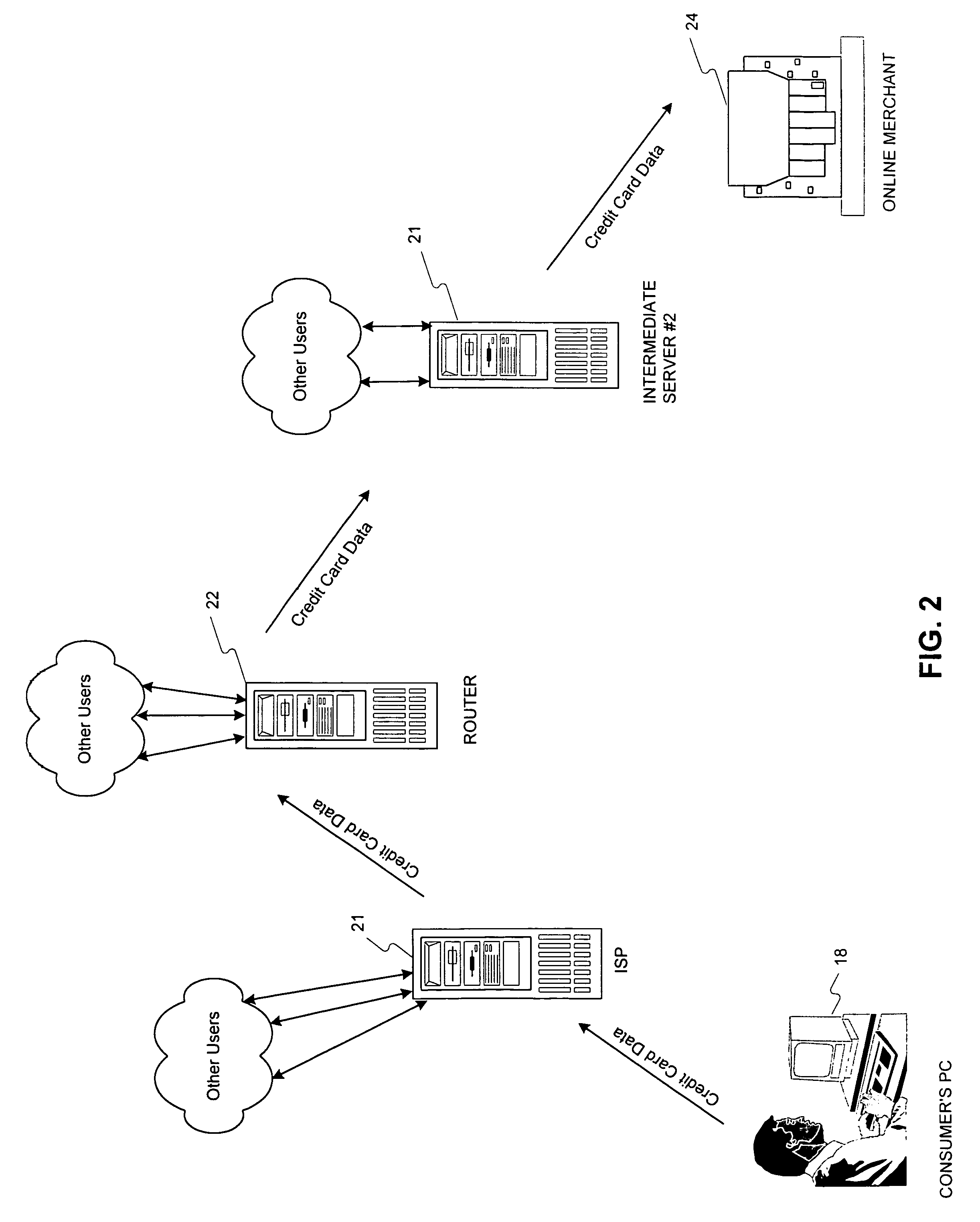

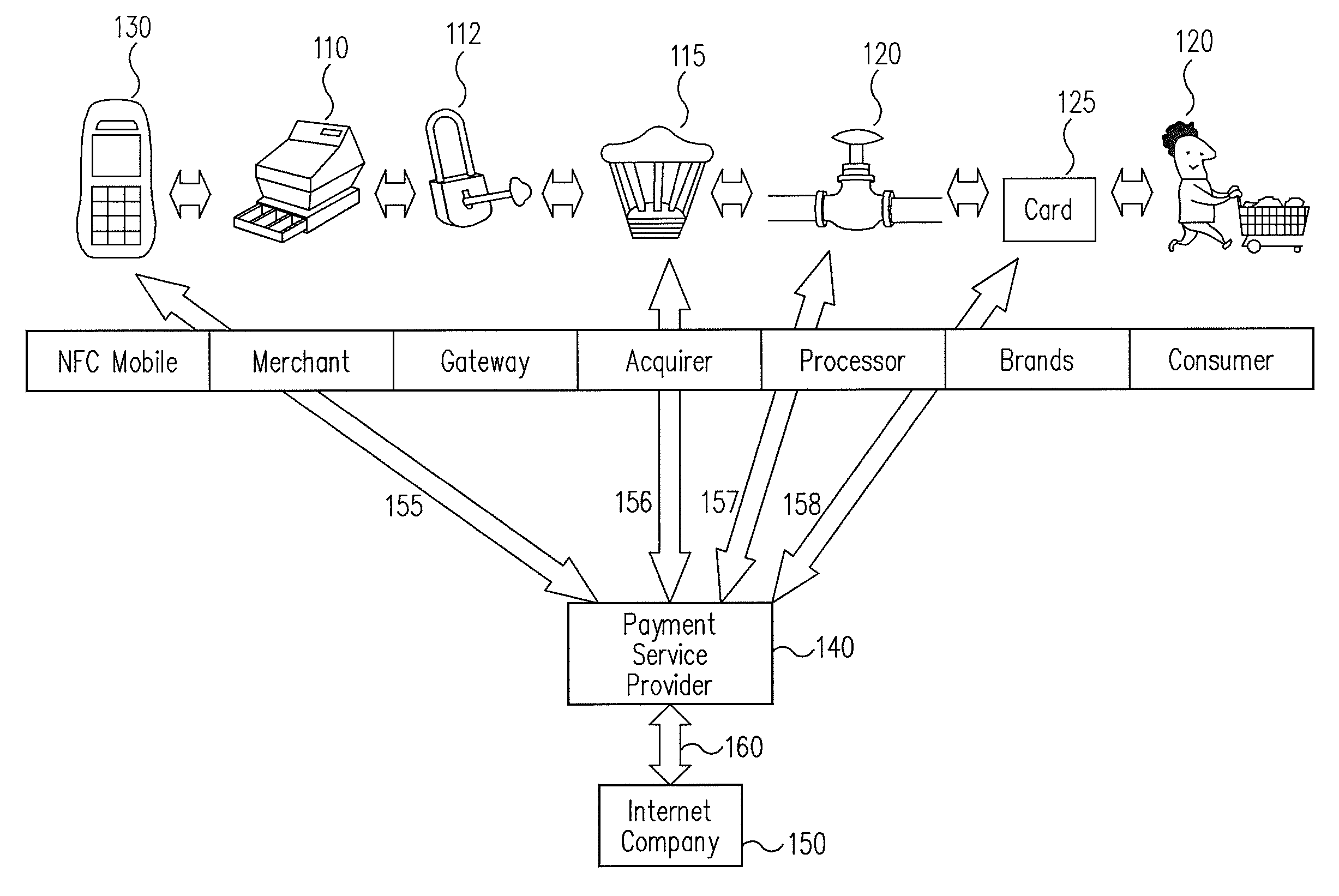

A novel system and methodology for conducting financial and other transactions using a wireless device. Credentials may be selectively issued by issuers such as credit card companies, banks, and merchants to consumers permitting the specific consumer to conduct a transaction according to the authorization given as reflected by the credential or set of credentials. The preferred mechanism for controlling and distributing credentials according to the present invention is through one or more publicly accessible networks such as the Internet wherein the system design and operating characteristics are in conformance with the standards and other specific requirements of the chosen network or set of networks. Credentials are ultimately supplied to a handheld device such as a mobile telephone via a wireless network. The user holding the credential may then use the handheld device to conduct the authorized transaction or set of transactions via, for example, a short range wireless link with a point-of-sale terminal.

Owner:SAMSUNG ELECTRONICS CO LTD

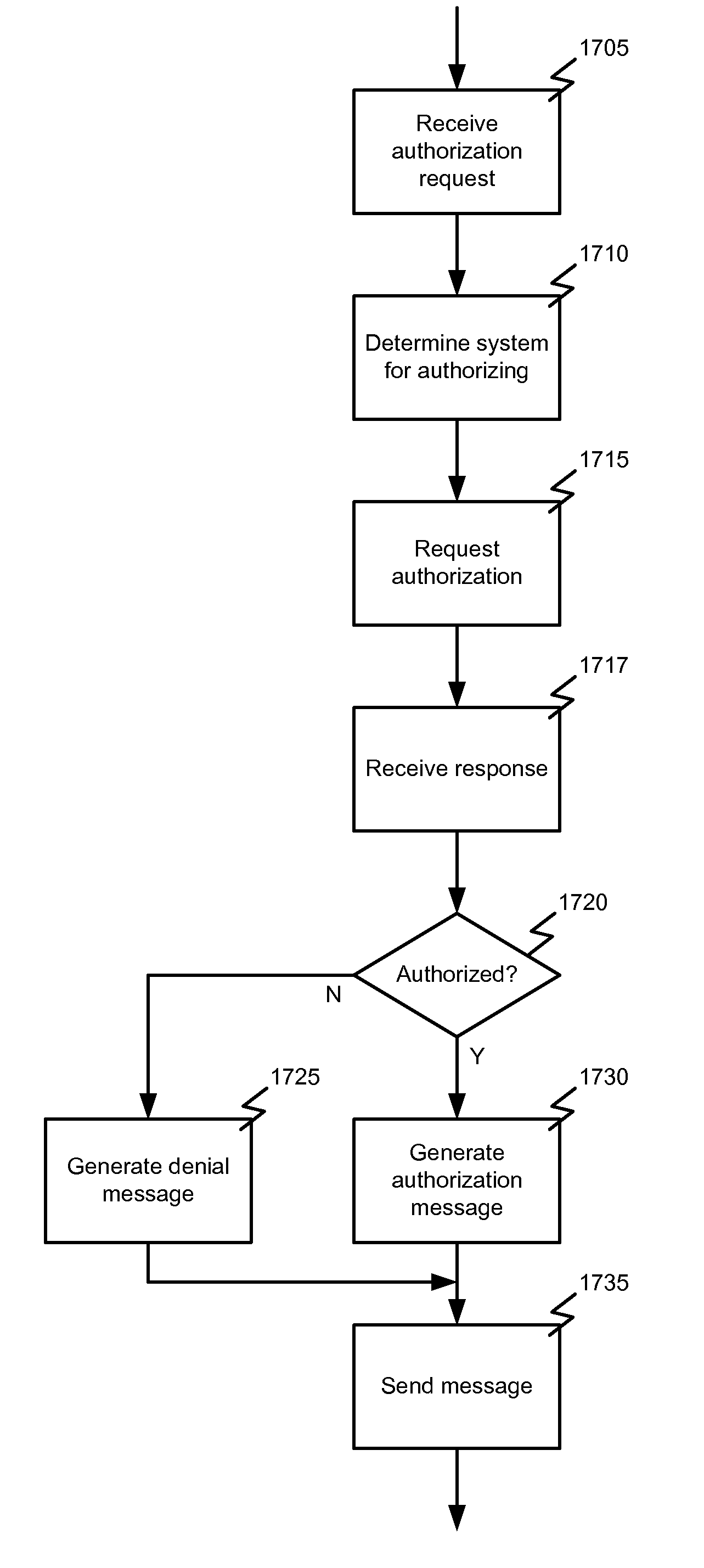

Payments using a mobile commerce device

InactiveUS20080208762A1Buying/selling/leasing transactionsPoint-of-sale network systemsPayment transactionAuthorization

Methods, systems, and machine-readable media are disclosed for handling payment transactions in a mobile commerce system. According to one embodiment, a method of processing a payment transaction in a mobile commerce system can comprise receiving at a first acquirer system a communication from a point-of-sale (POS) device. The communication can be related to the payment transaction and can include information identifying a financial account from which a payment is requested. A second acquirer for authorizing the payment can be identified based on the information identifying the financial account. The communication can be sent to the second acquirer system for authorization of the transaction based on the information related to the financial account. An indication of whether the transaction is authorized can be received from the second acquirer system.

Owner:FIRST DATA

System and method for processing financial transactions

InactiveUS7571139B1Improve securityGreat degree of convenienceFinanceCash registersPaymentFinancial transaction

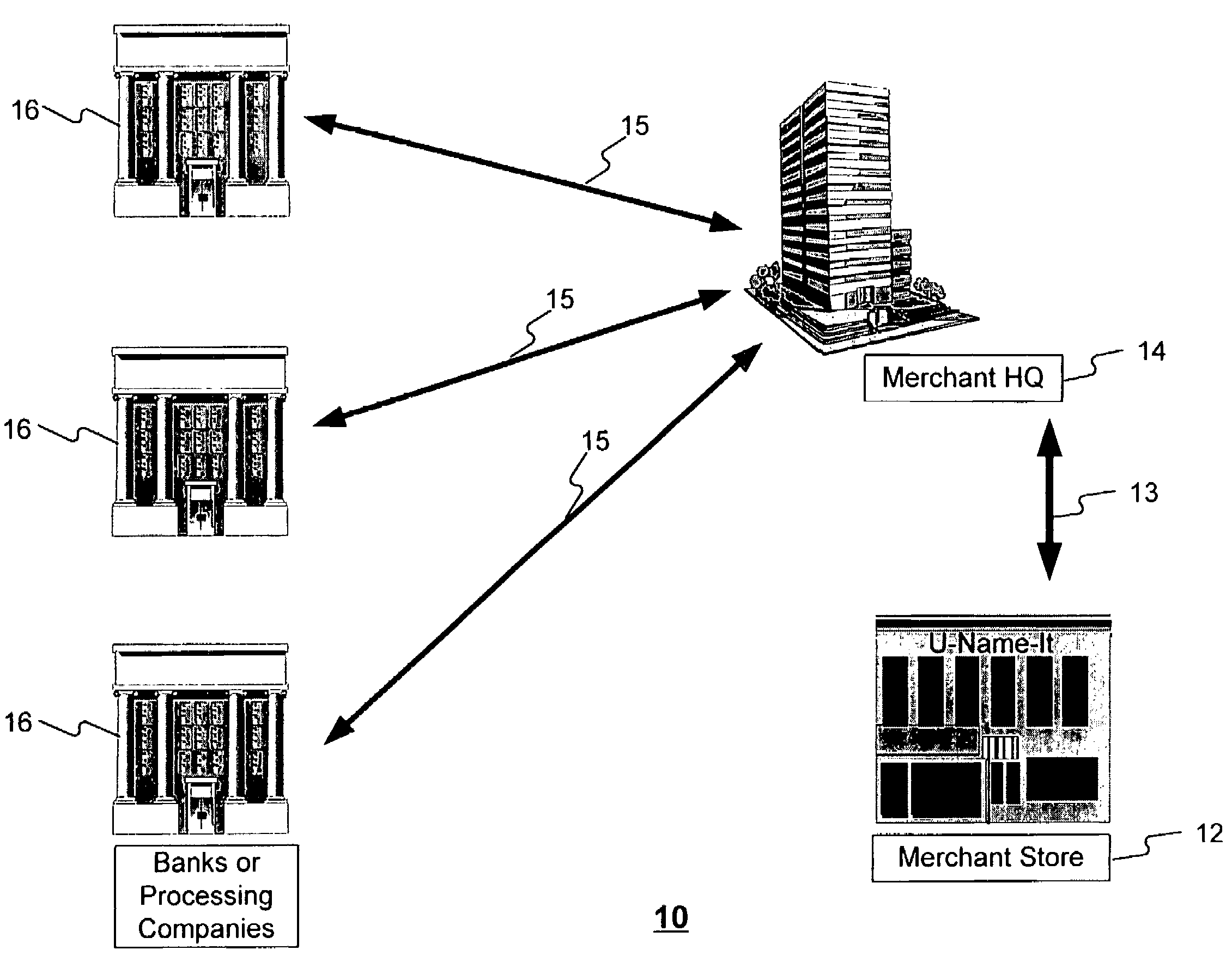

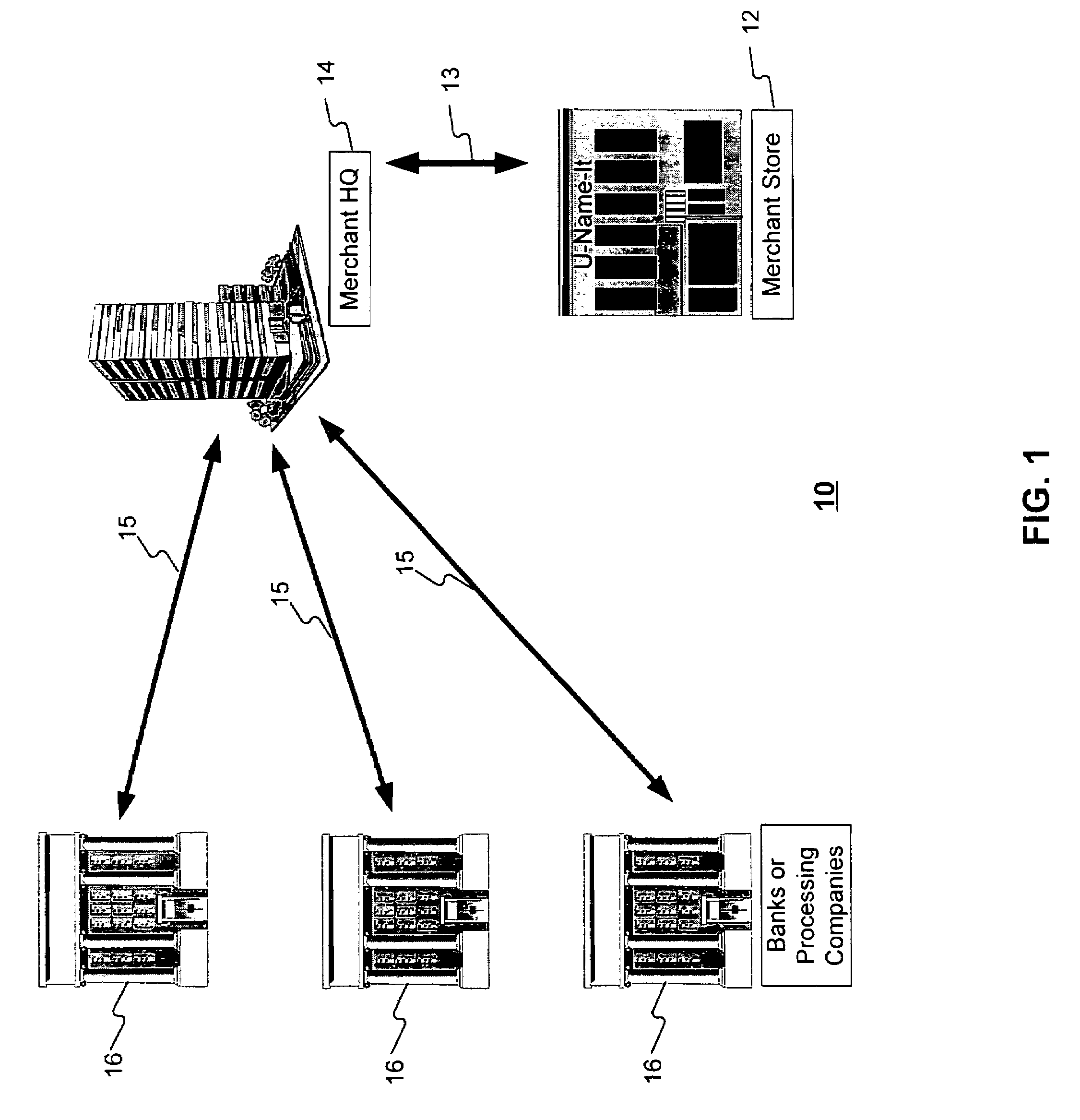

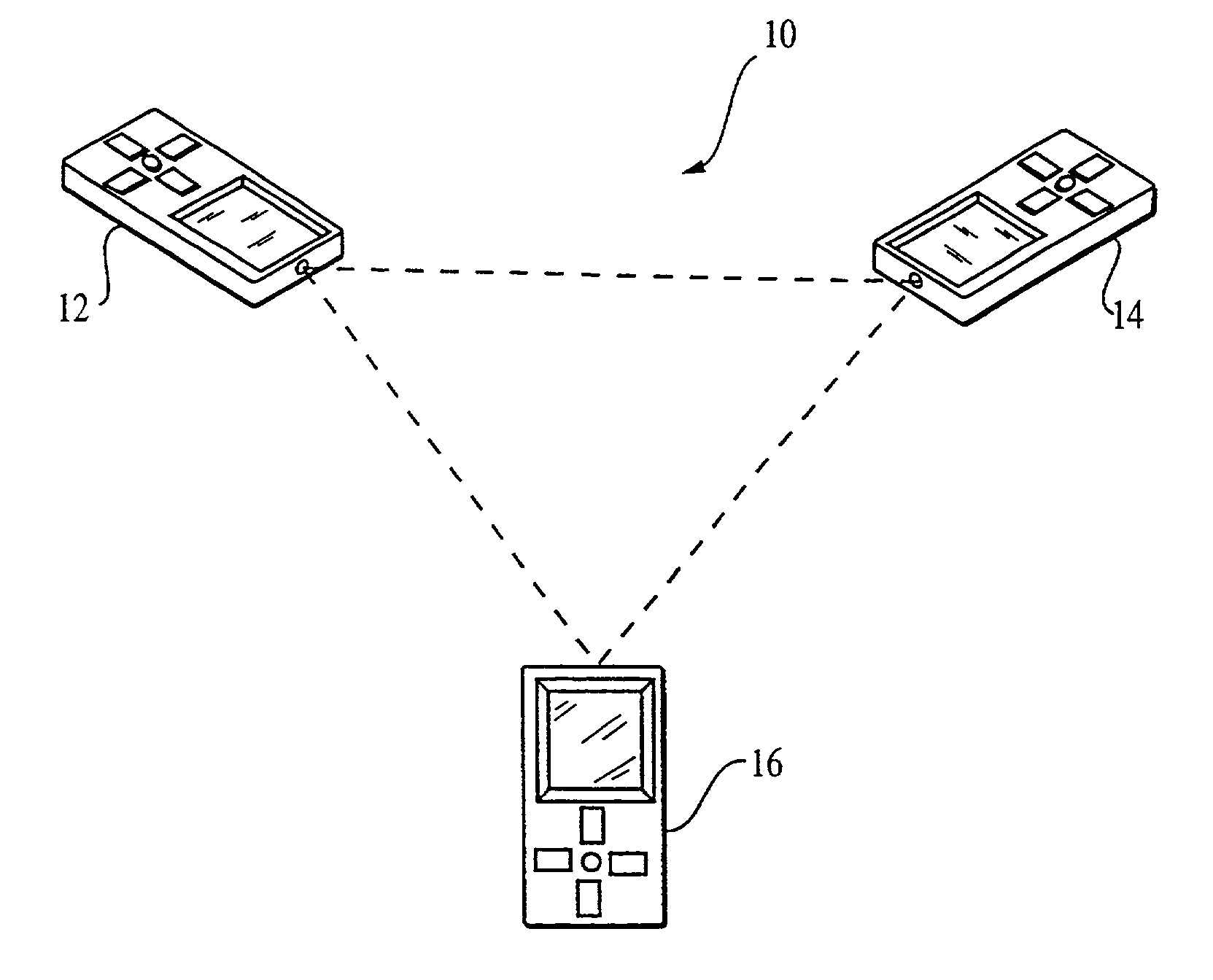

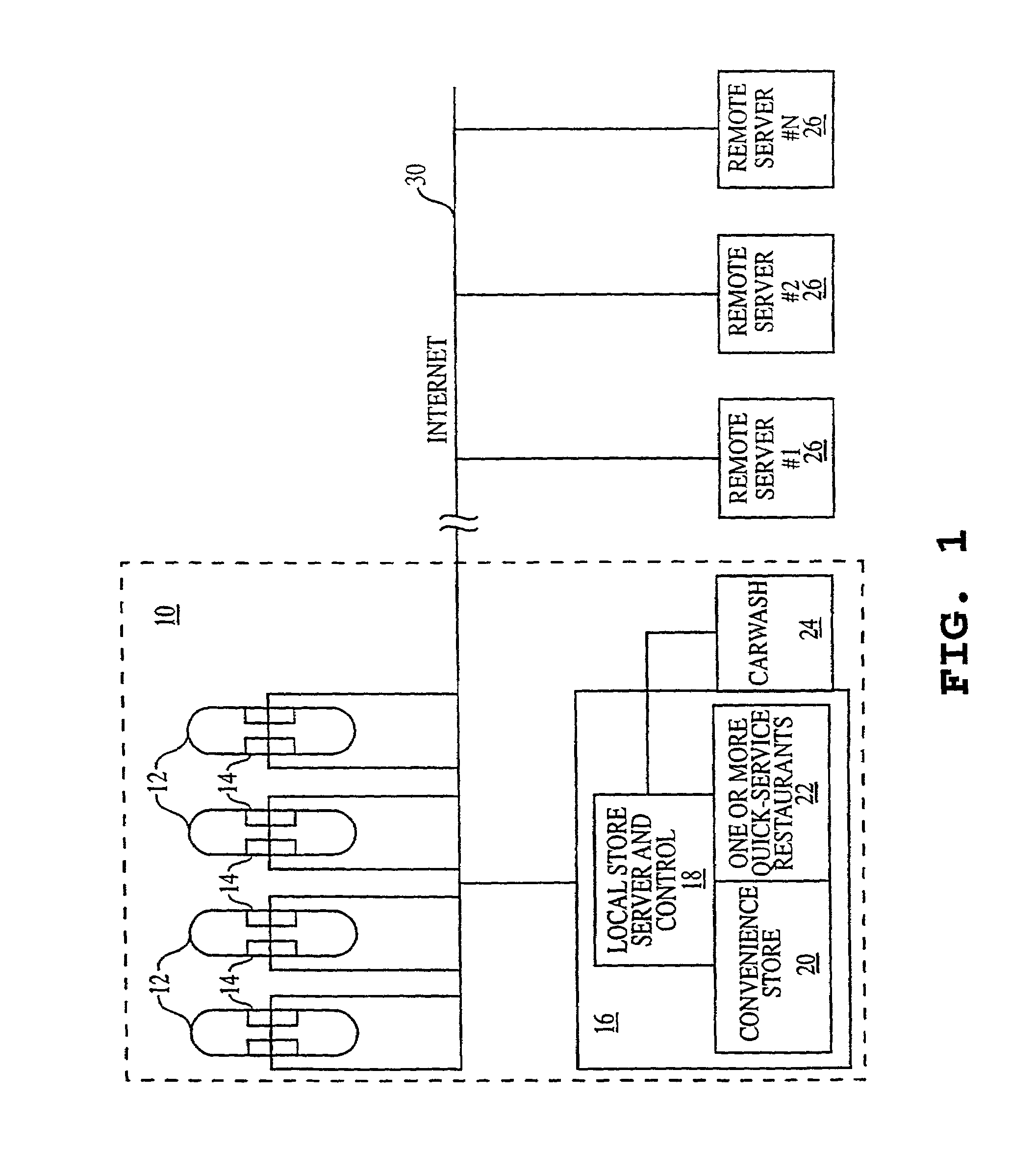

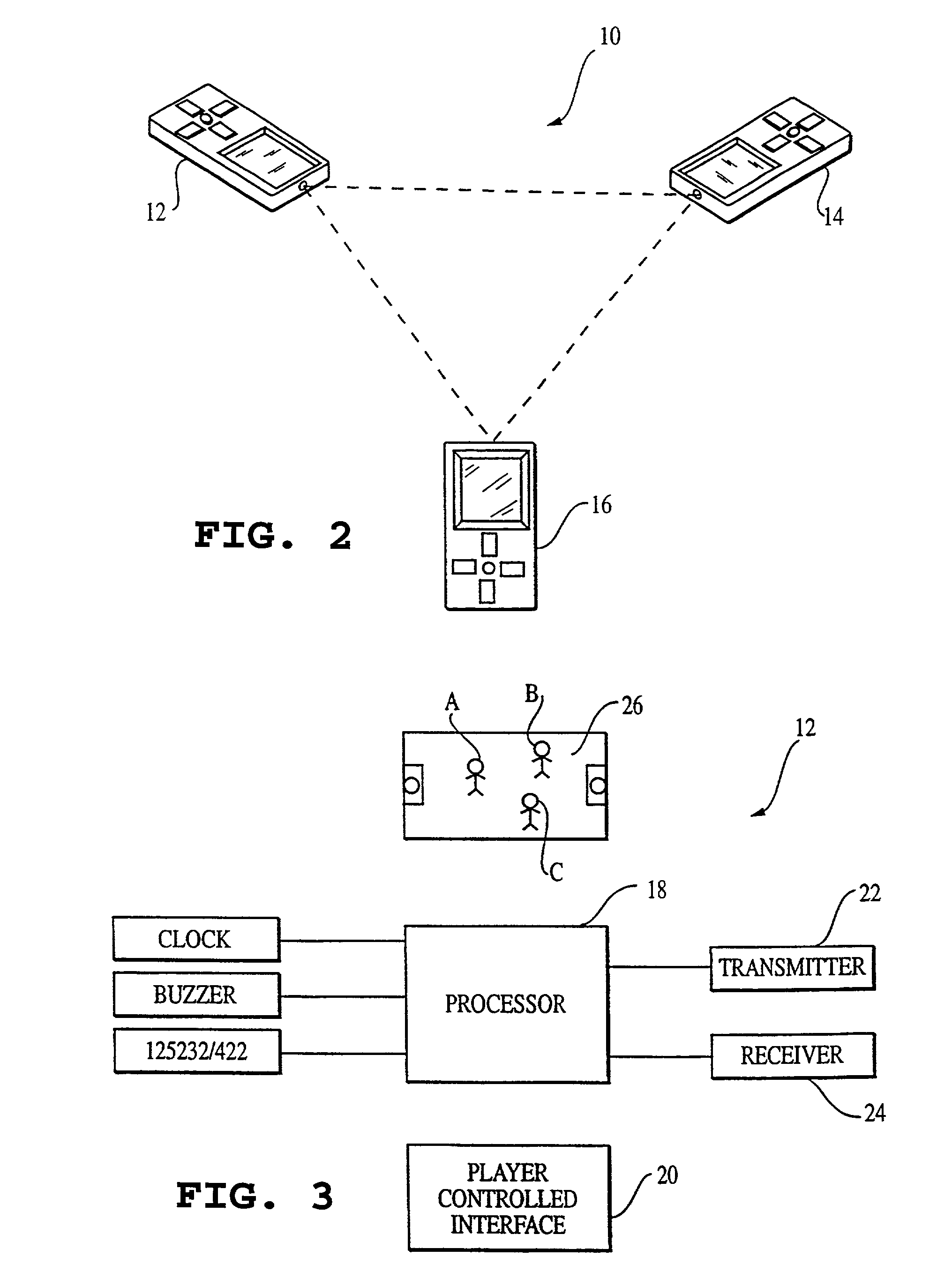

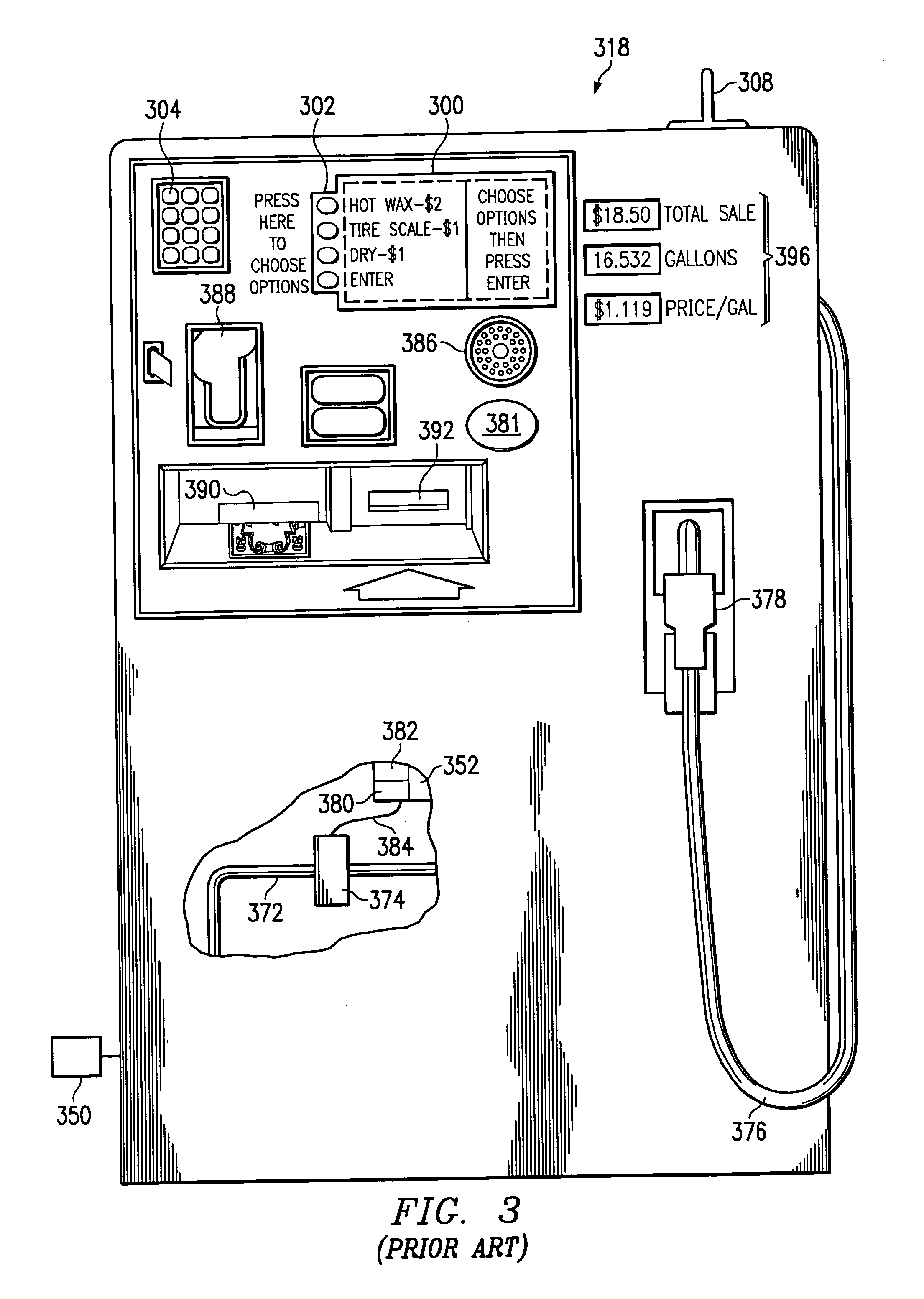

A network for processing retail sales transactions includes a customer transceiver with a unique customer number, a reader receiving the customer number and sending it to a point-of-sale device where it is combined with transaction information to form a transaction entry. The transaction entry is sent through a merchant computer to a transaction processing system having a customer database. The transaction processing system references an entry in the customer database corresponding to the customer / transmitter ID number and routes the transaction entry to a payment processing system specified in the customer database entry.

Owner:EXXON RES & ENG CO +1

System and method for reallocating and/or upgrading and/or rewarding tickets, other event admittance means, goods and/or services

InactiveUS7031945B1To offer comfortIncrease the fun of activitiesMarket predictionsTicket-issuing apparatusPoint of saleUpgrade

Owner:EASTERN IX GRP +1

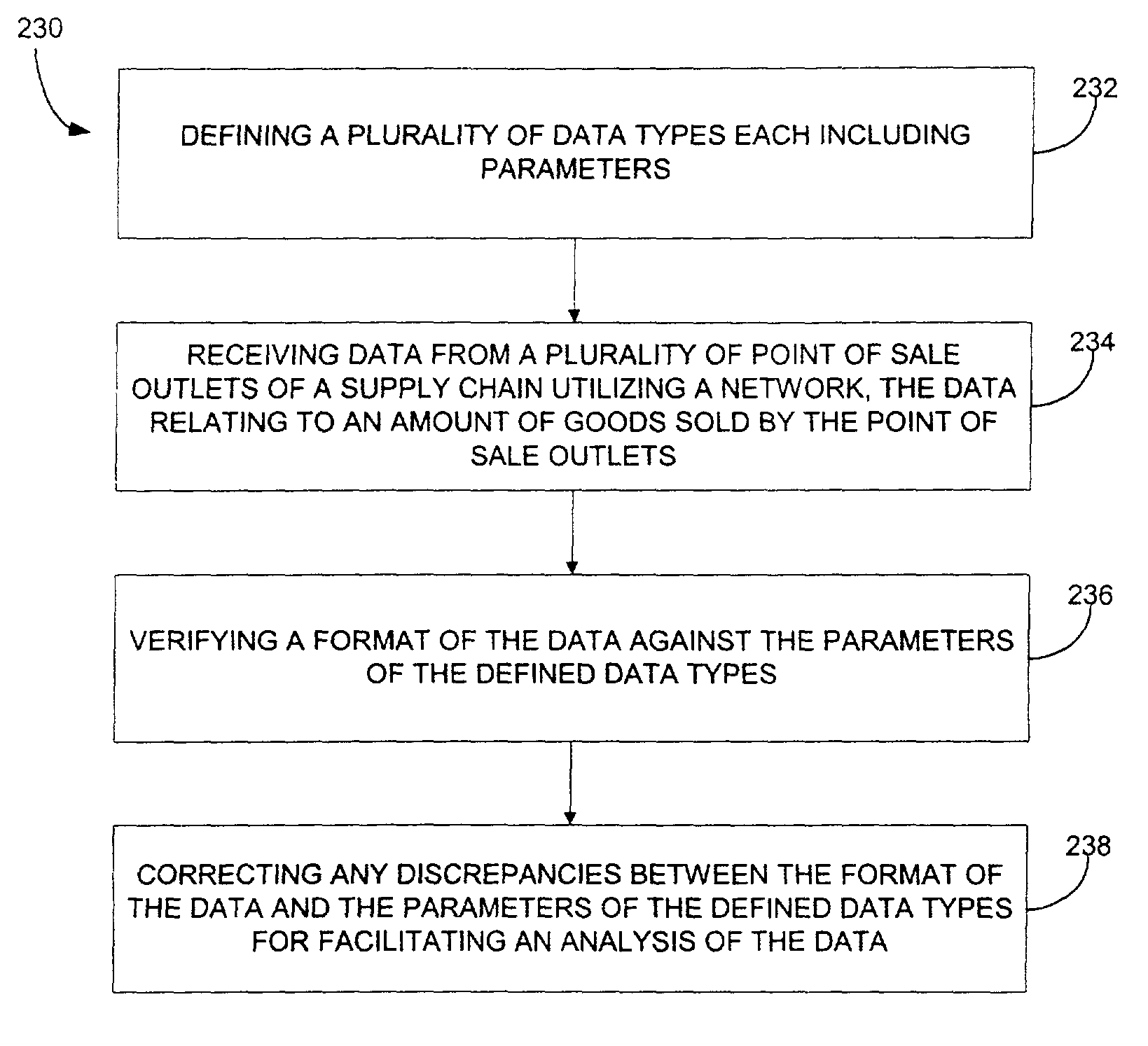

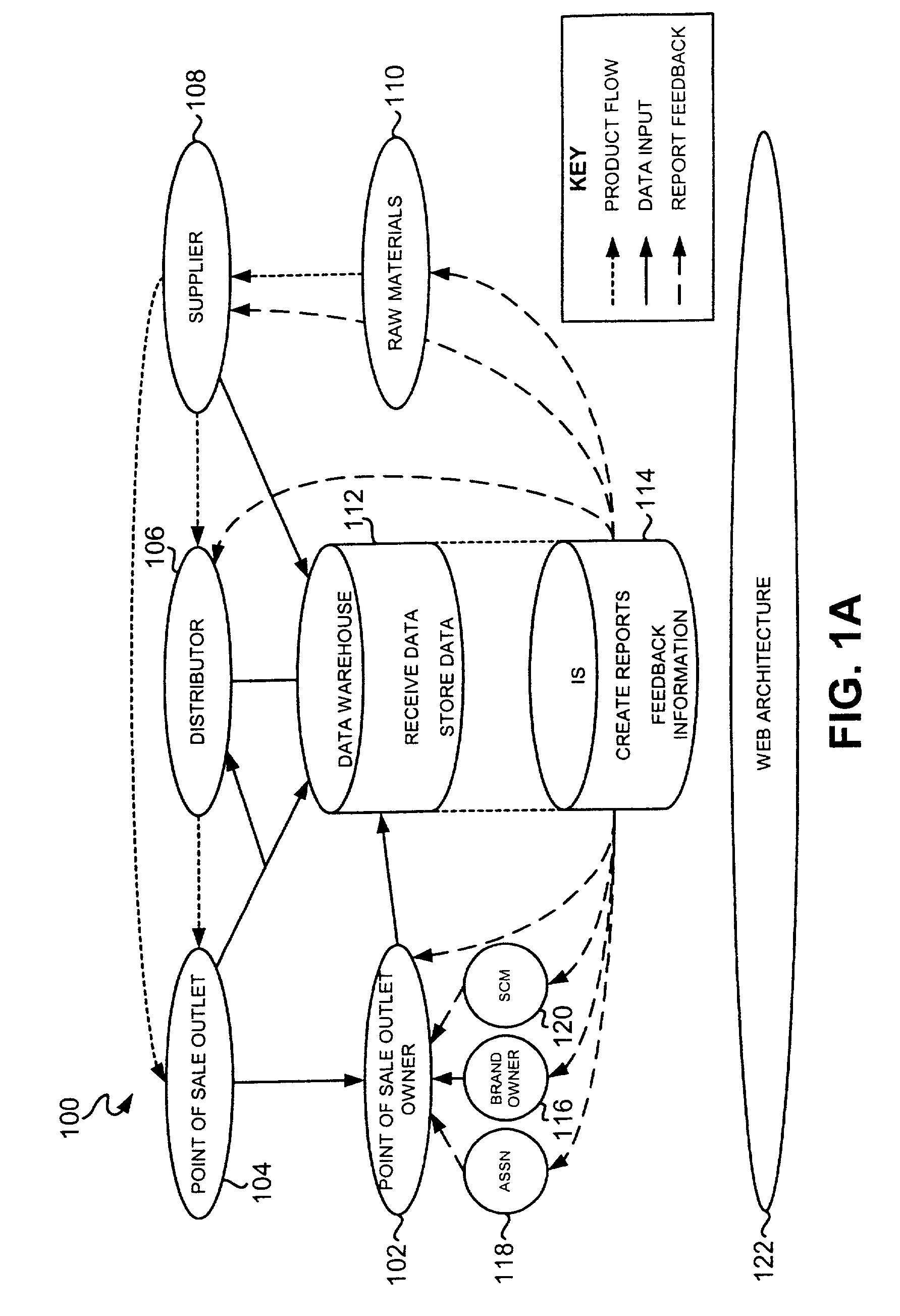

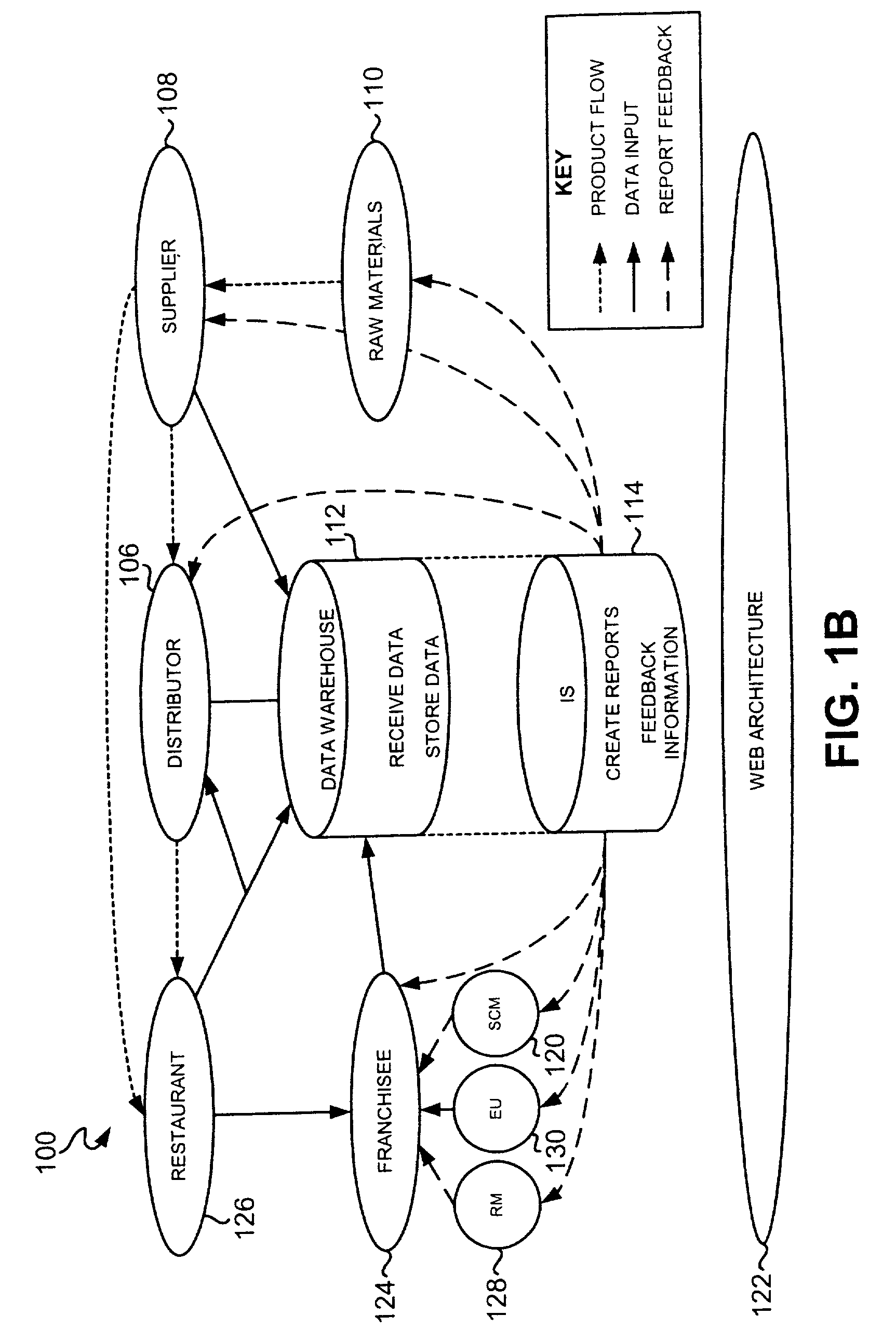

System, method and computer program product for normalizing data in a supply chain management framework

A system, method and computer program product are disclosed for normalizing data in a supply chain management framework. A plurality of data types are defined with each data type including parameters. Data is received utilizing a network from a plurality of point of sale outlets of a supply chain that relates to an amount of goods sold by the point of sale outlets. A format of the data is verified against the parameters of the defined data types and any discrepancies between the format of the data and the parameters of the defined data types are corrected for facilitating an analysis of the data.

Owner:RESTAURANT SERVICES

Biometric authentication of mobile financial transactions by trusted service managers

ActiveUS20090307139A1Digital data processing detailsUser identity/authority verificationUser inputFinancial transaction

A method for authenticating a financial transaction at a point of sale (POS) includes storing an application program in a first secure element of a mobile phone. The application is configured to generate instruction codes to effect the financial transaction upon verification of a user's identity. The user's credentials are stored in a second SE of the phone, which is operable to verify the user's identity from a biometric trait of the user input to the phone and to generate data authenticating the financial transaction in response to the verification of the user's identity. At the POS, the user invokes the application and then inputs a biometric trait to the phone. The second SE verifies the user's identity, and upon verification, generates data authenticating the transaction. The financial transaction data, including the instruction codes and the authenticating data, are then transmitted from the phone to the POS.

Owner:PAYPAL INC

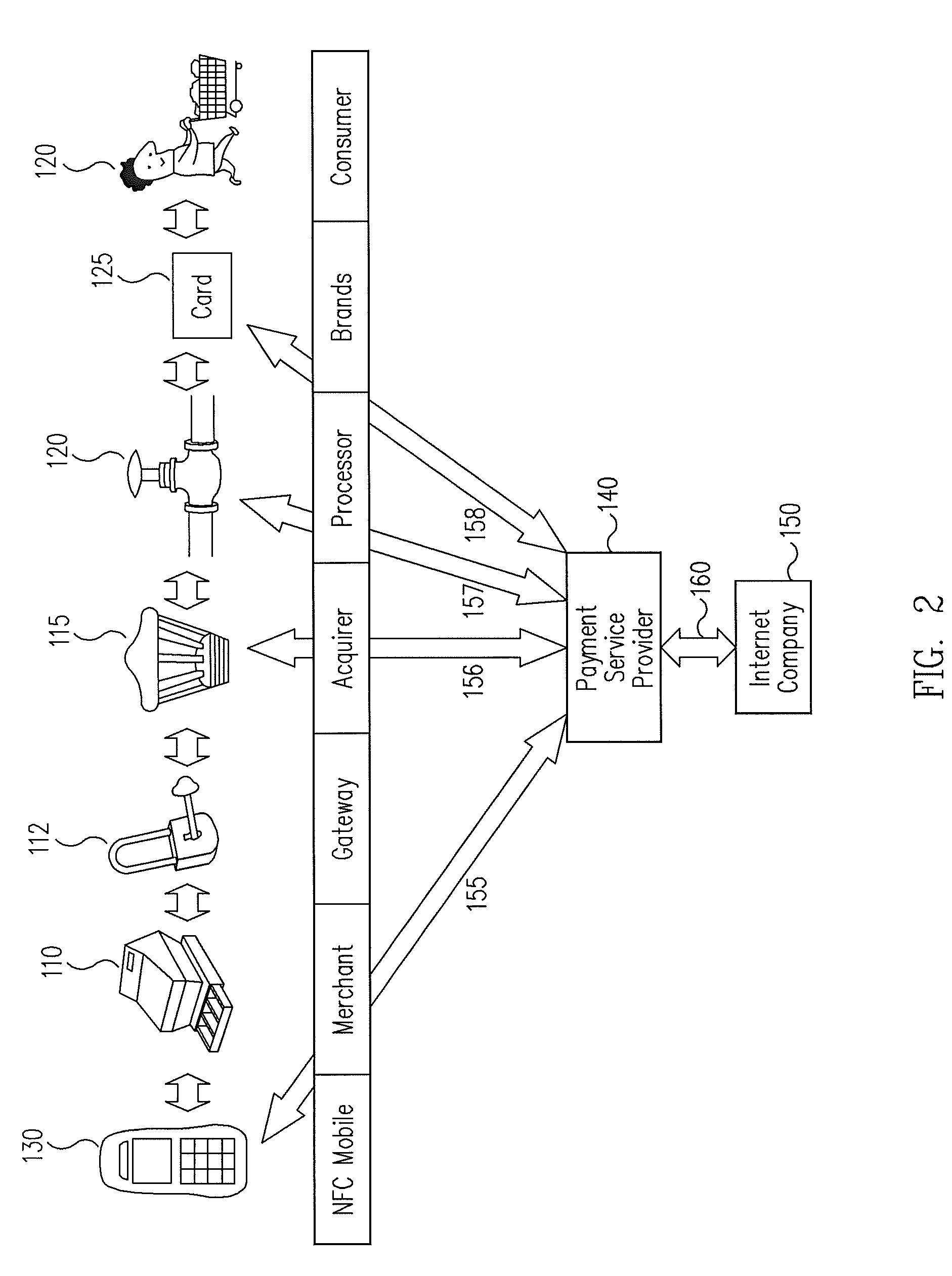

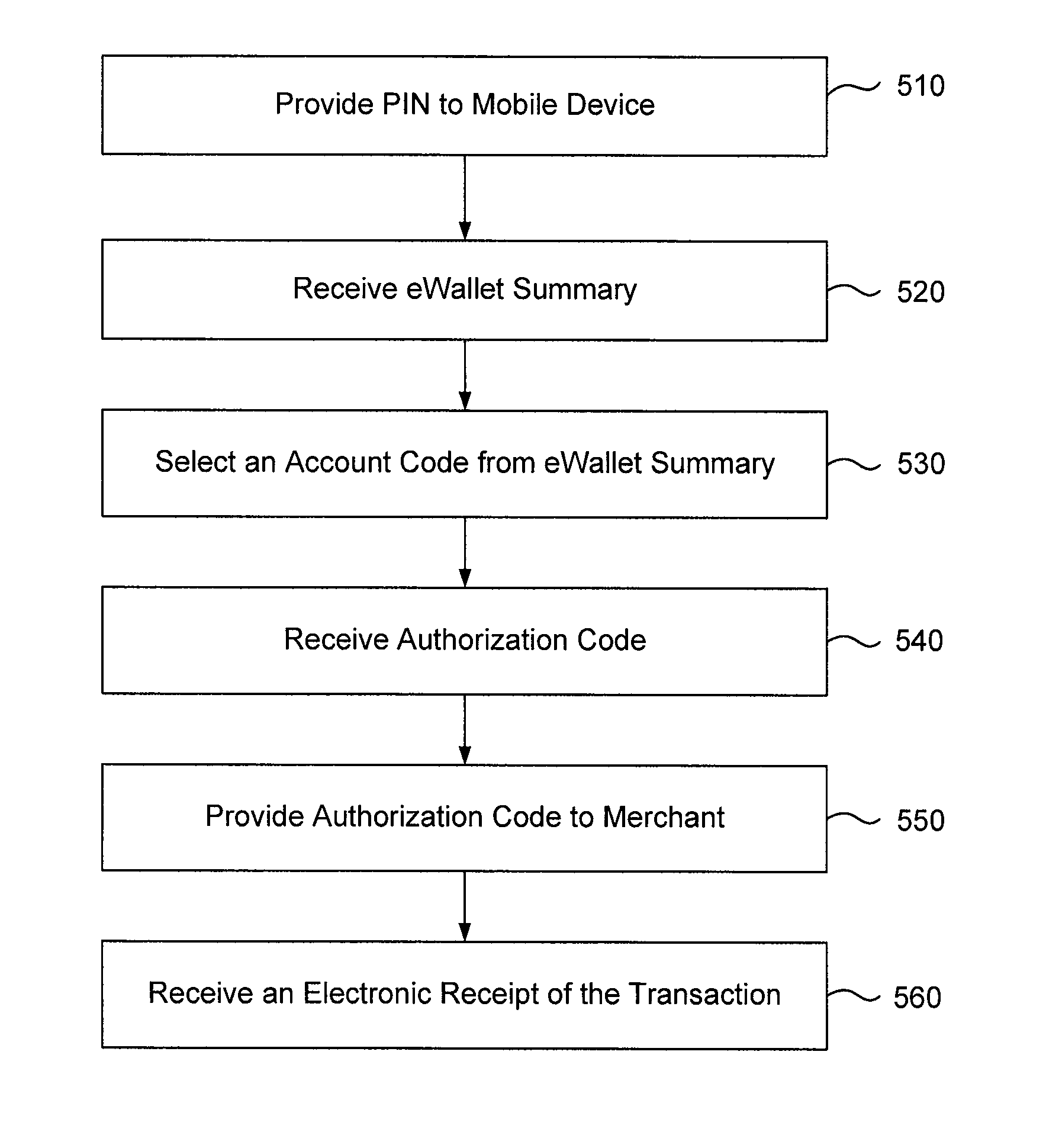

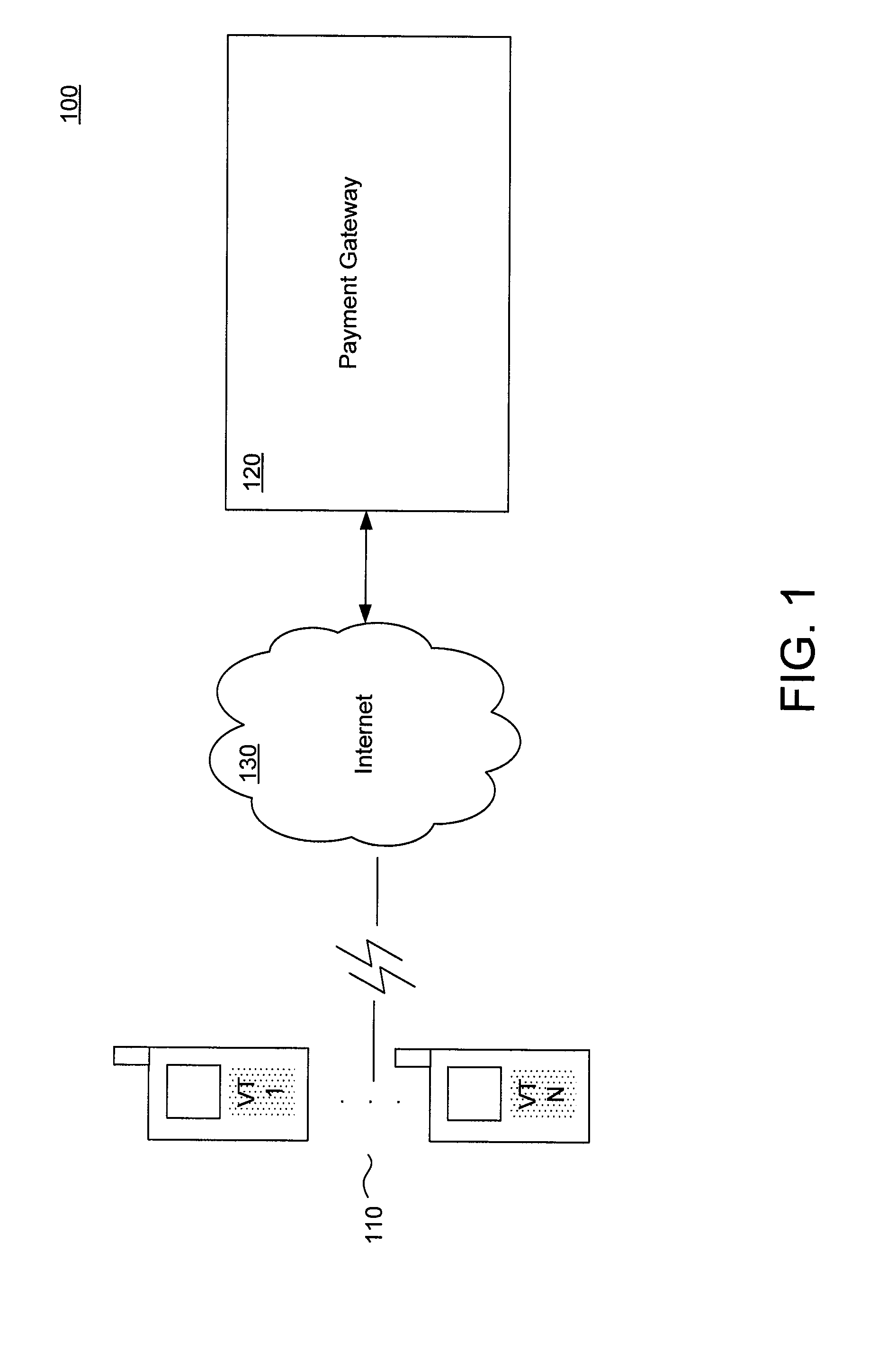

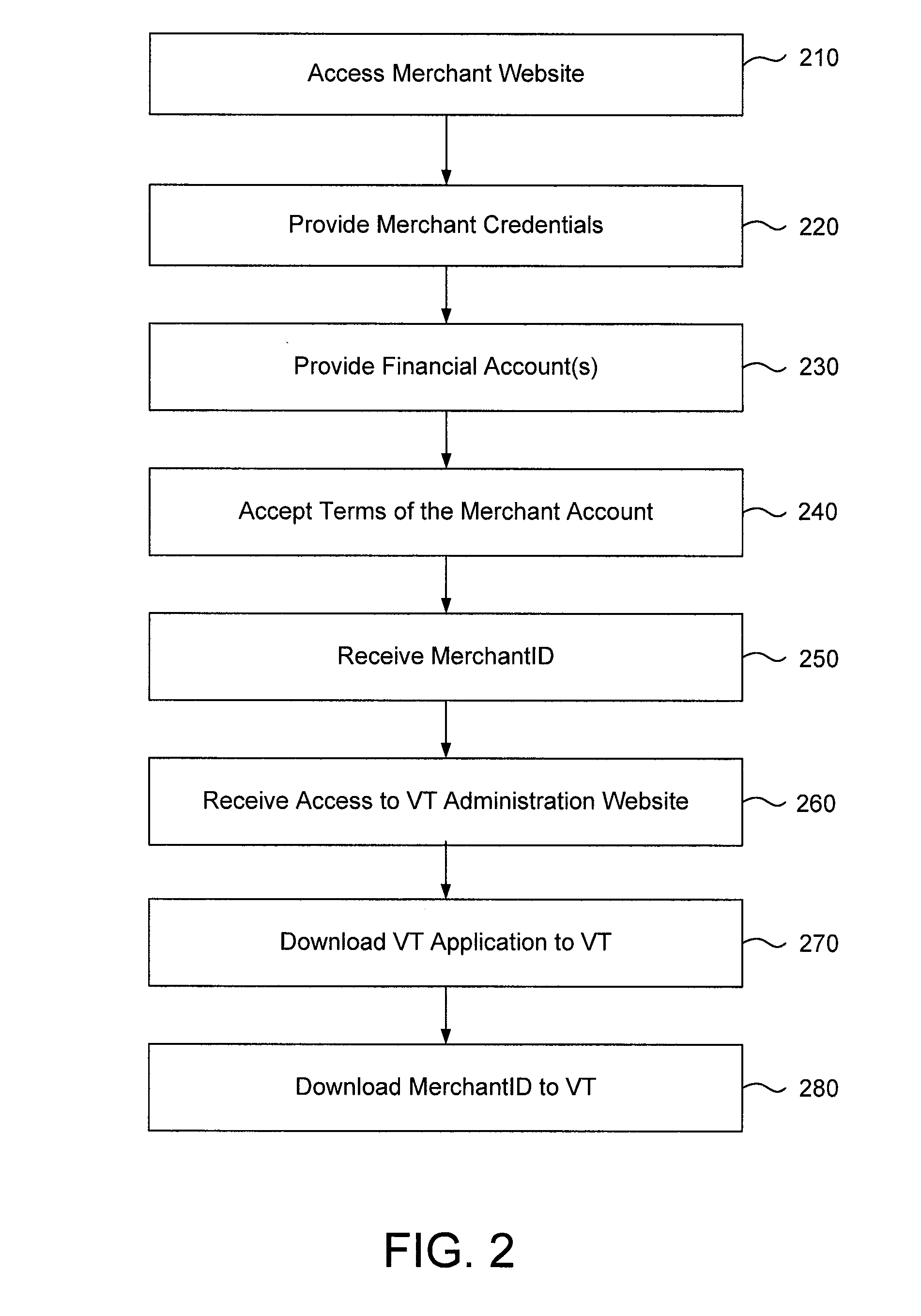

Method and System for Processing Secure Wireless Payment Transactions and for Providing a Virtual Terminal for Merchant Processing of Such Transactions

A system and method for processing a wireless electronic payment transaction is described. One embodiment comprises receiving a transaction authorization request for an electronic payment transaction from a customer, the authorization request submitted from a mobile communication device of the customer; authenticating the transaction authorization request; authorizing the transaction authorization request and transmitting an authorization code to the mobile communication device, the authorization code being communicated to a merchant from the customer; receiving a transaction approval request from the merchant, the transaction approval request submitted from a virtual terminal associated with the merchant, the virtual terminal being a wireless communication device having a point of sale processing application installed therein; authenticating the transaction approval request; approving the transaction approval request and transmitting an approval code to the virtual terminal; and generating and executing transaction settlement instructions between a financial account of the customer and a financial account of the merchant.

Owner:MOCAPAY

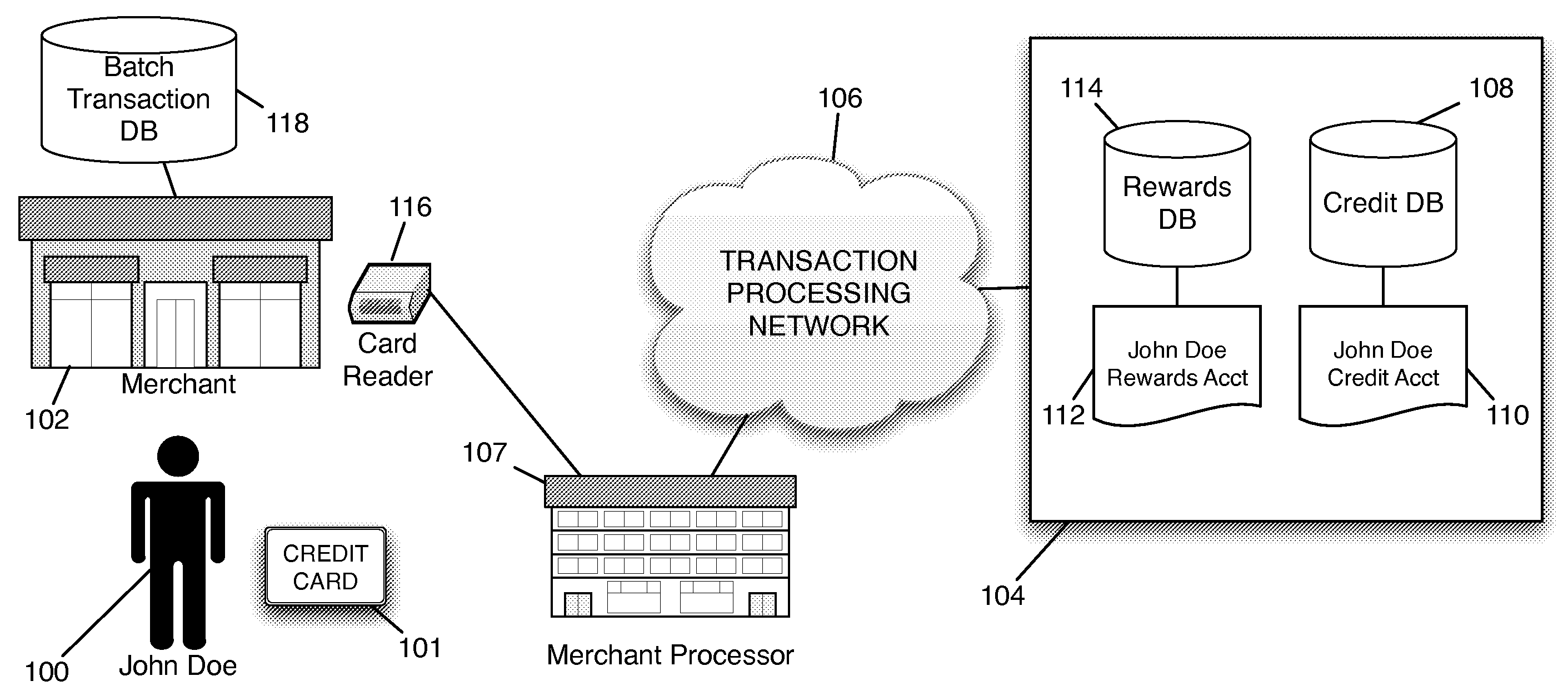

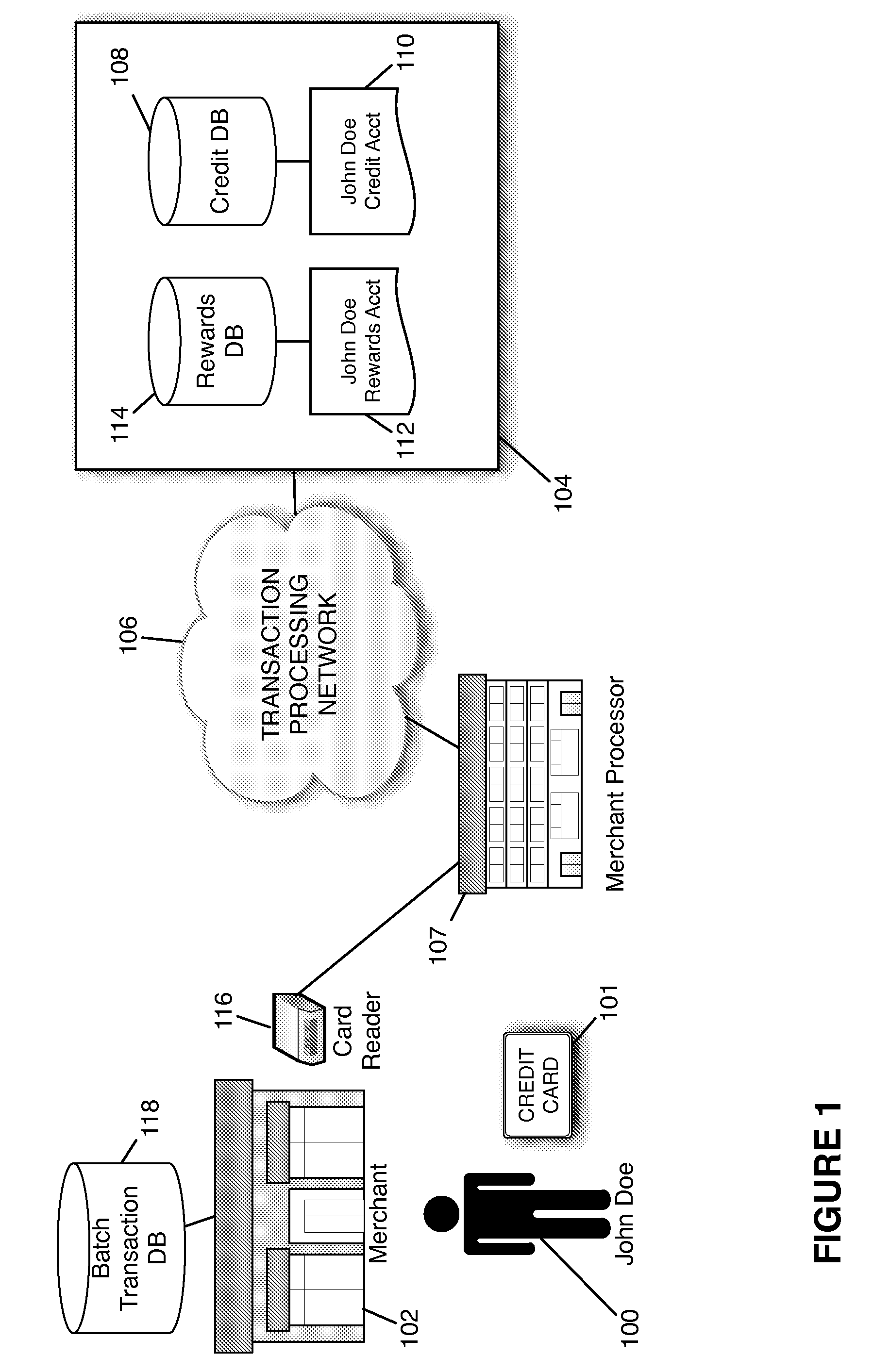

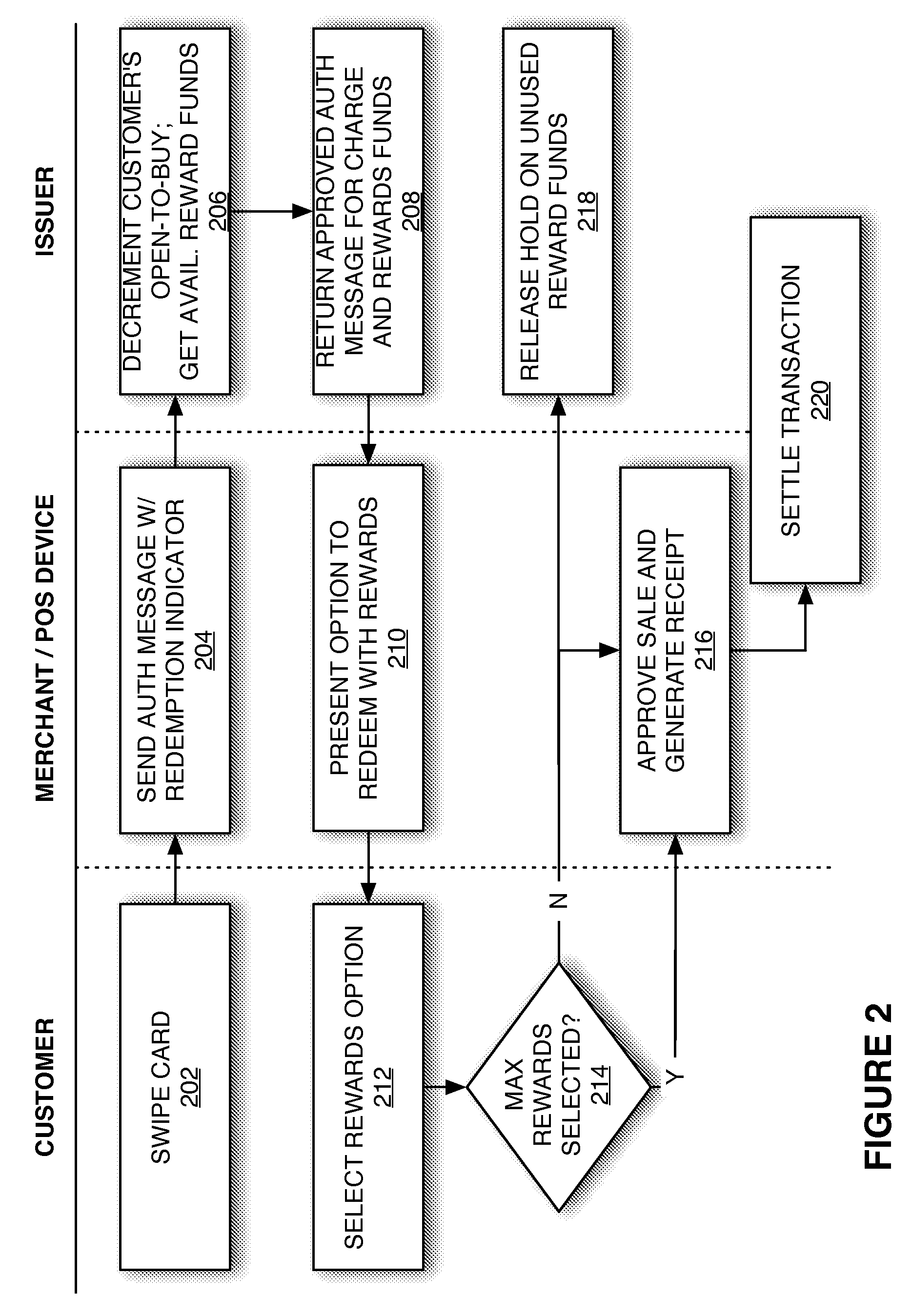

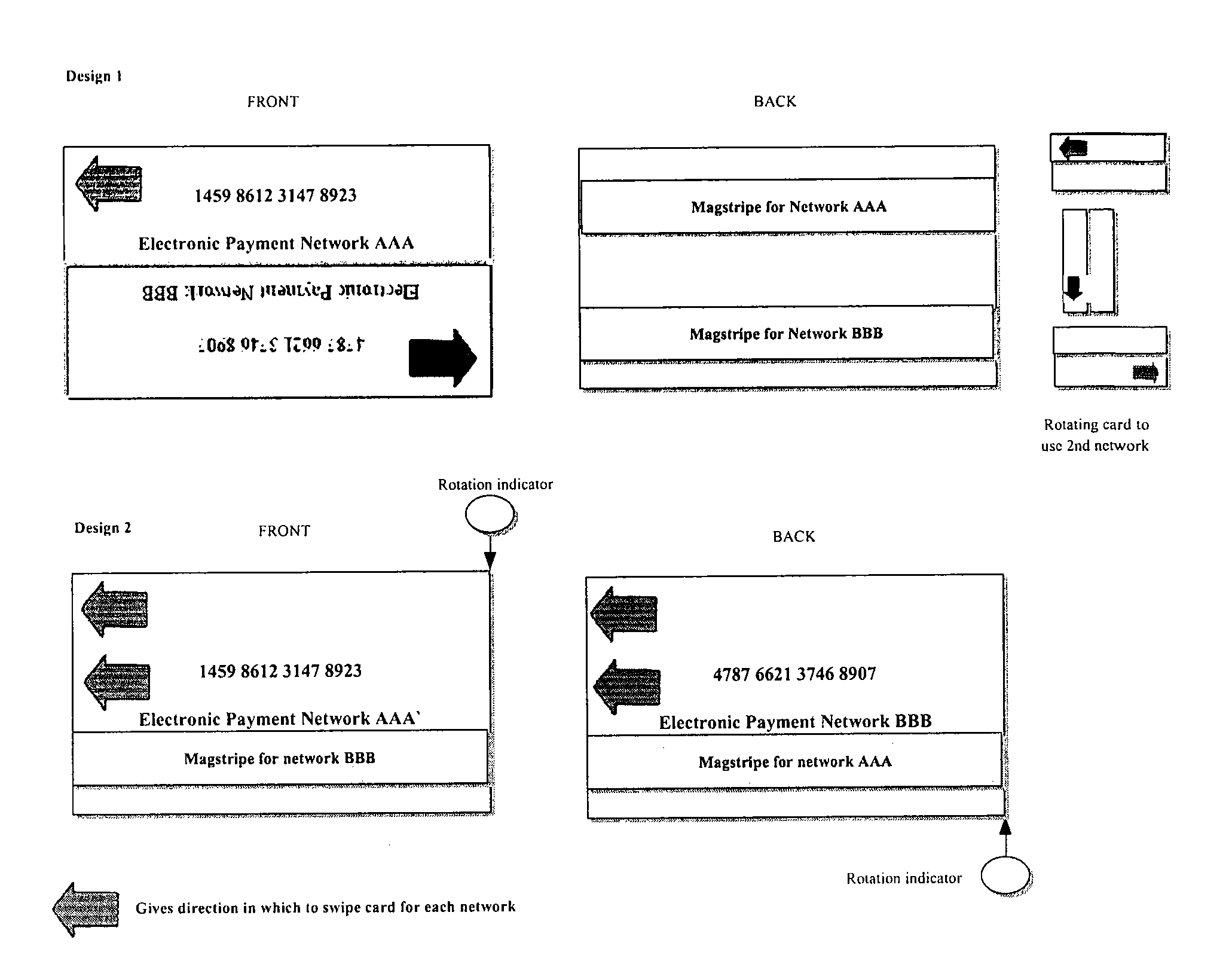

Redemption of Credit Card Rewards at a Point of Sale

Systems and methods are described for redeeming rewards at a merchant's point-of-sale. The reward redemption takes place in real time and can be accomplished without the active participation of the merchant. A single credit card with no additional information may be used with a single swipe from the consumer to access both credit and rewards accounts, such that a single authorization request is made to encompass both rewards and credit. Merchants can be fully compensated for transactions by the issuer despite the customer's choice to redeem rewards.

Owner:DFS SERVICES

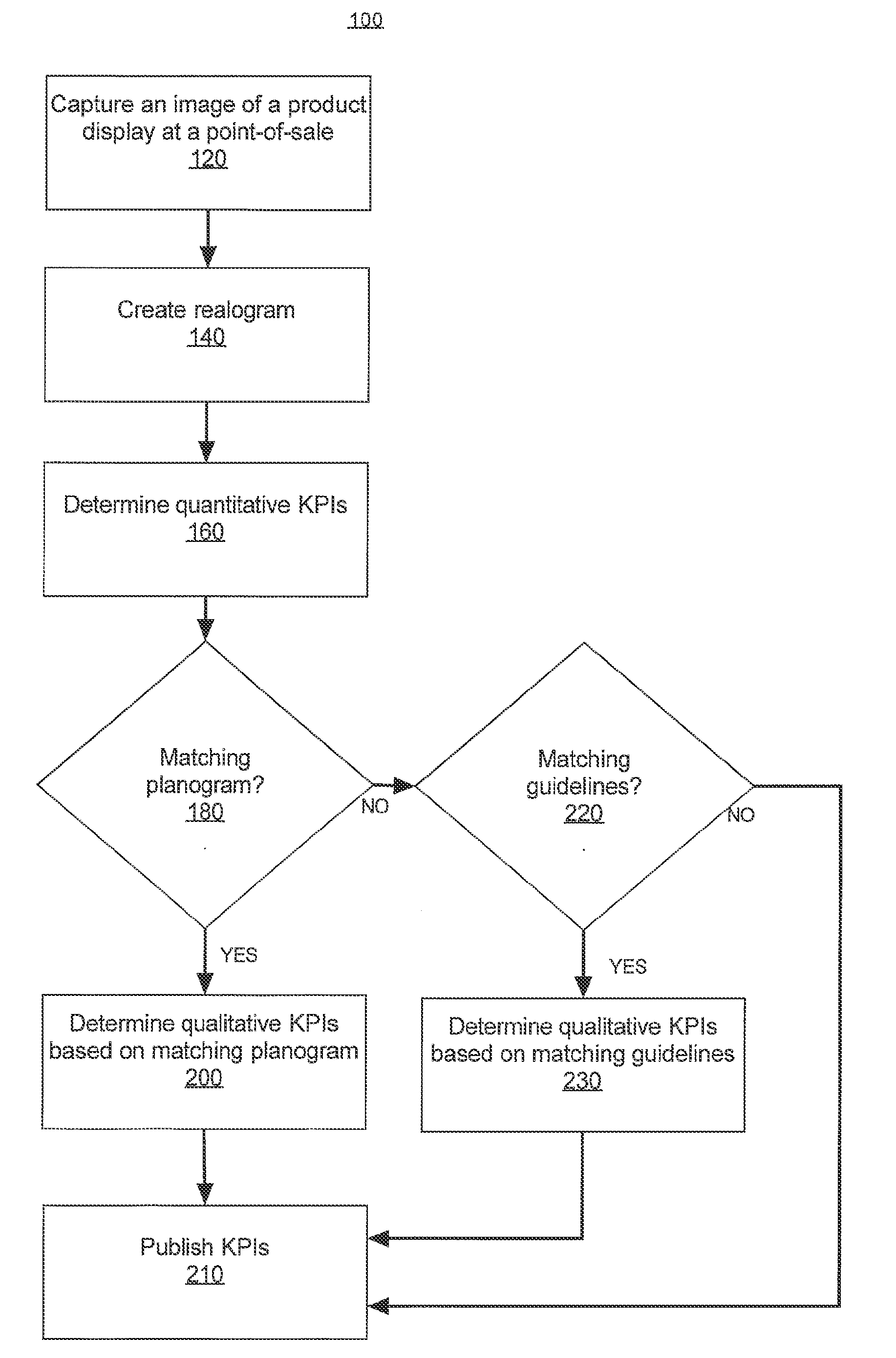

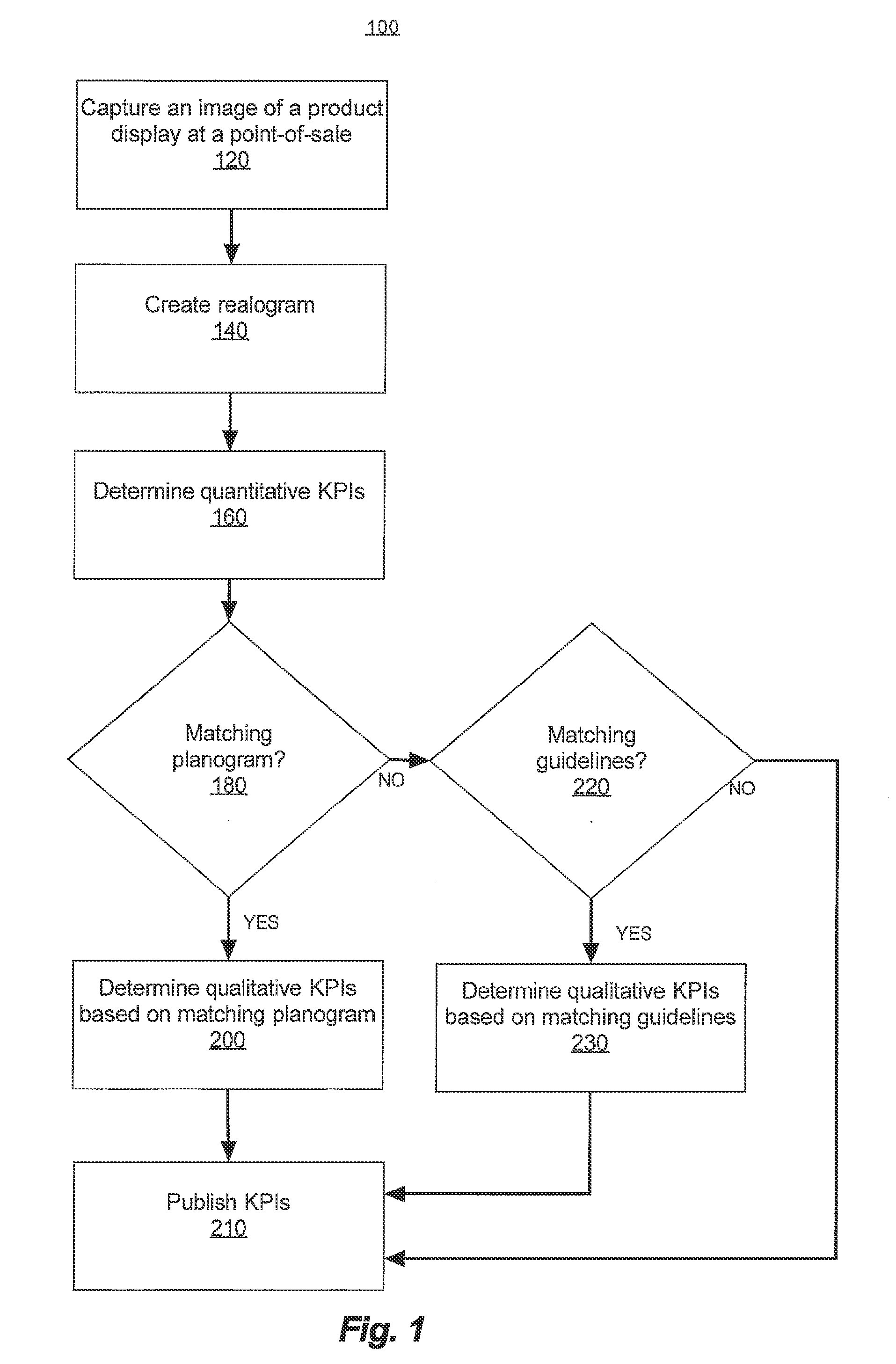

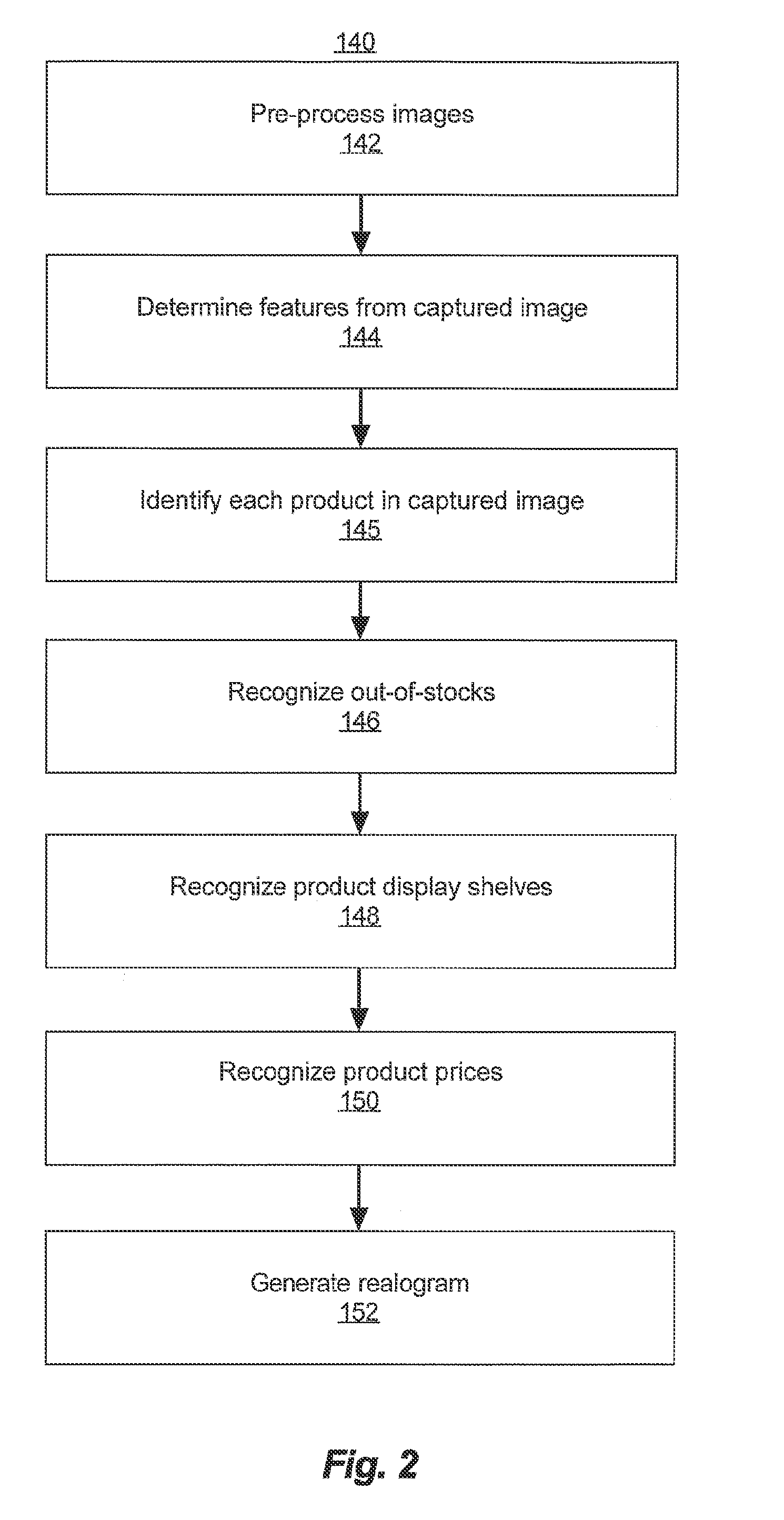

Digital point-of-sale analyzer

ActiveUS20110011936A1Ensure complianceCharacter and pattern recognitionPayment architectureGraphicsComputer science

A digital point-of-sale system for determining key performance indicators (KPIs) at a point-of-sale includes a product identification unit and a realogram creation unit. The product identification unit is configured to receive a captured image of a product display and to identify products in the captured image by comparing features determined from the captured image to features determined from products templates. The realogram creation unit is configured to create a realogram from the identified products and product templates. A product price KPI unit is configured to identify a product label proximally located to each identified product, and to recognize the product price on each product label. Each product price is compared to a predetermined range of prices to determine whether the product label proximally located to the identified product is a correct product label for the identified product.

Owner:ACCENTURE GLOBAL SERVICES LTD

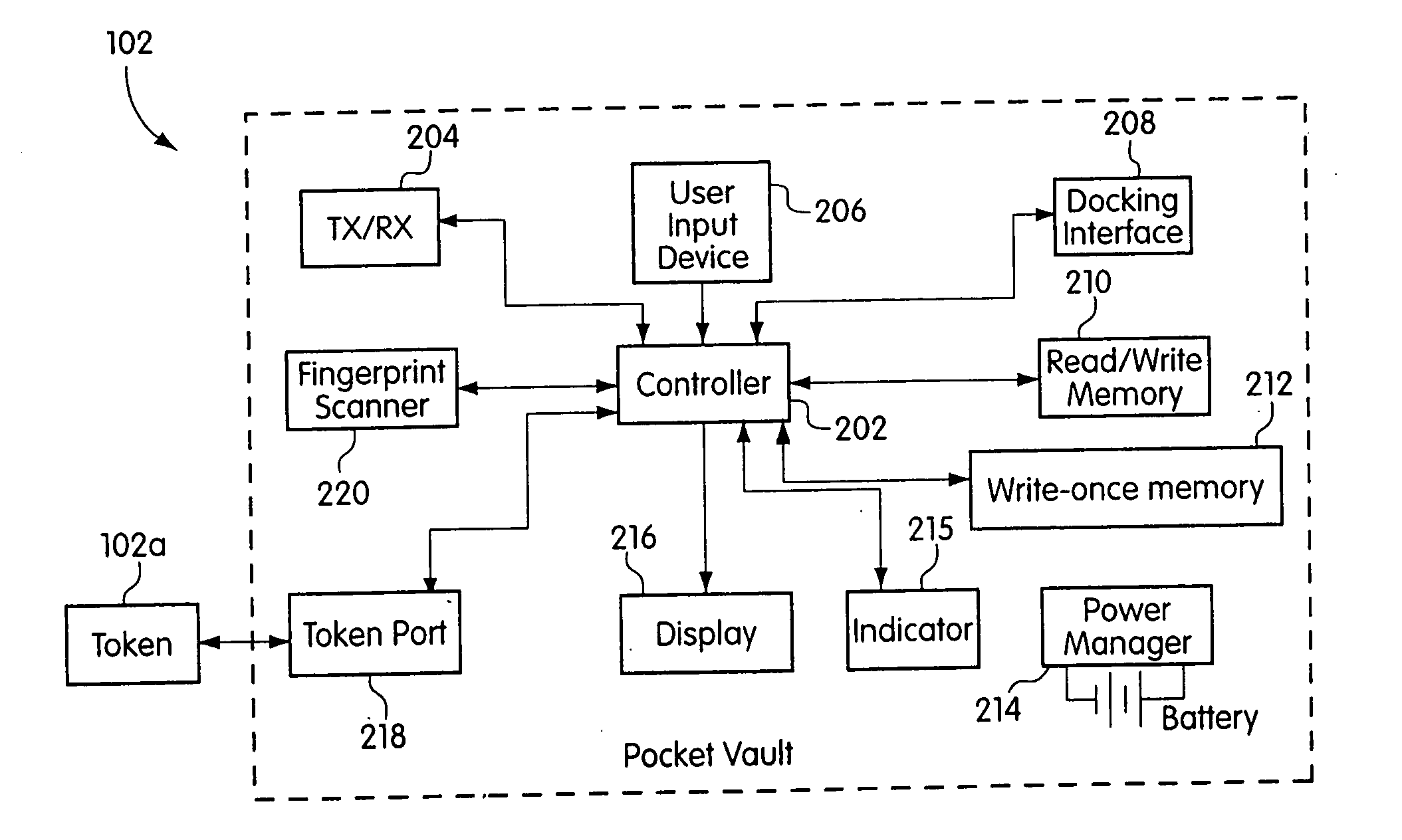

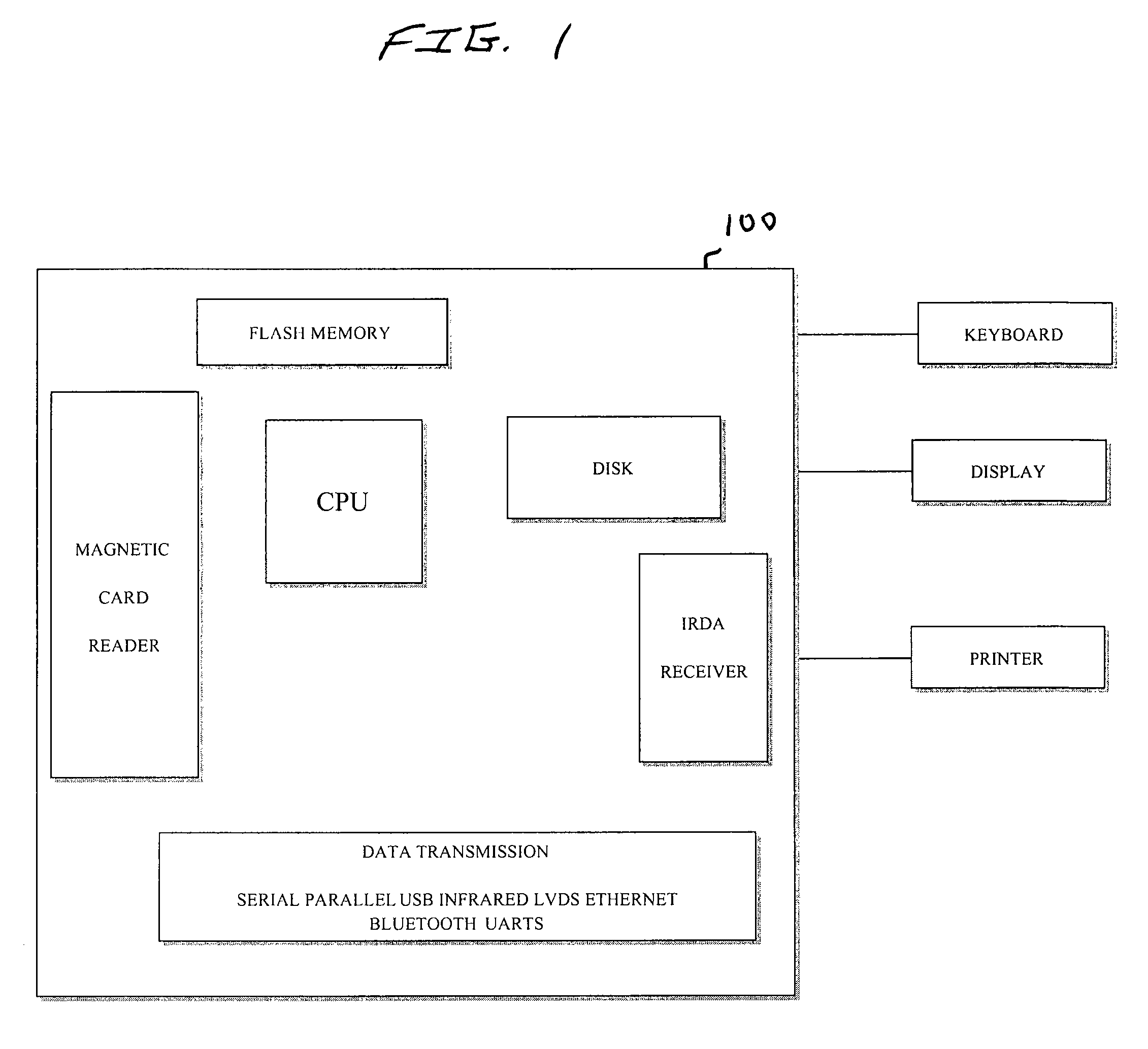

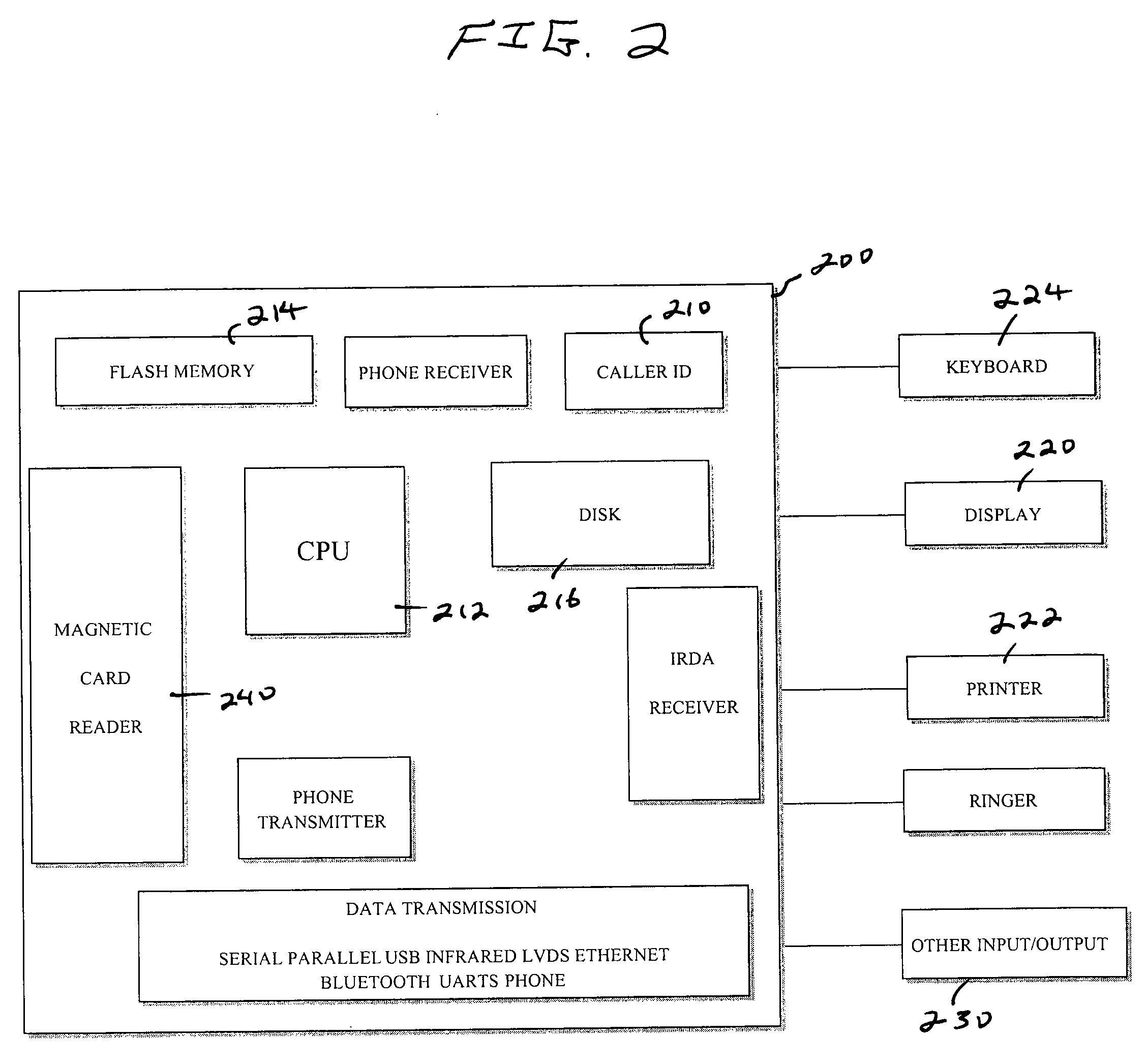

Portable electronic authorization system and method

Owner:ZILOS NETWORKING LIMITED LIABILITY +1

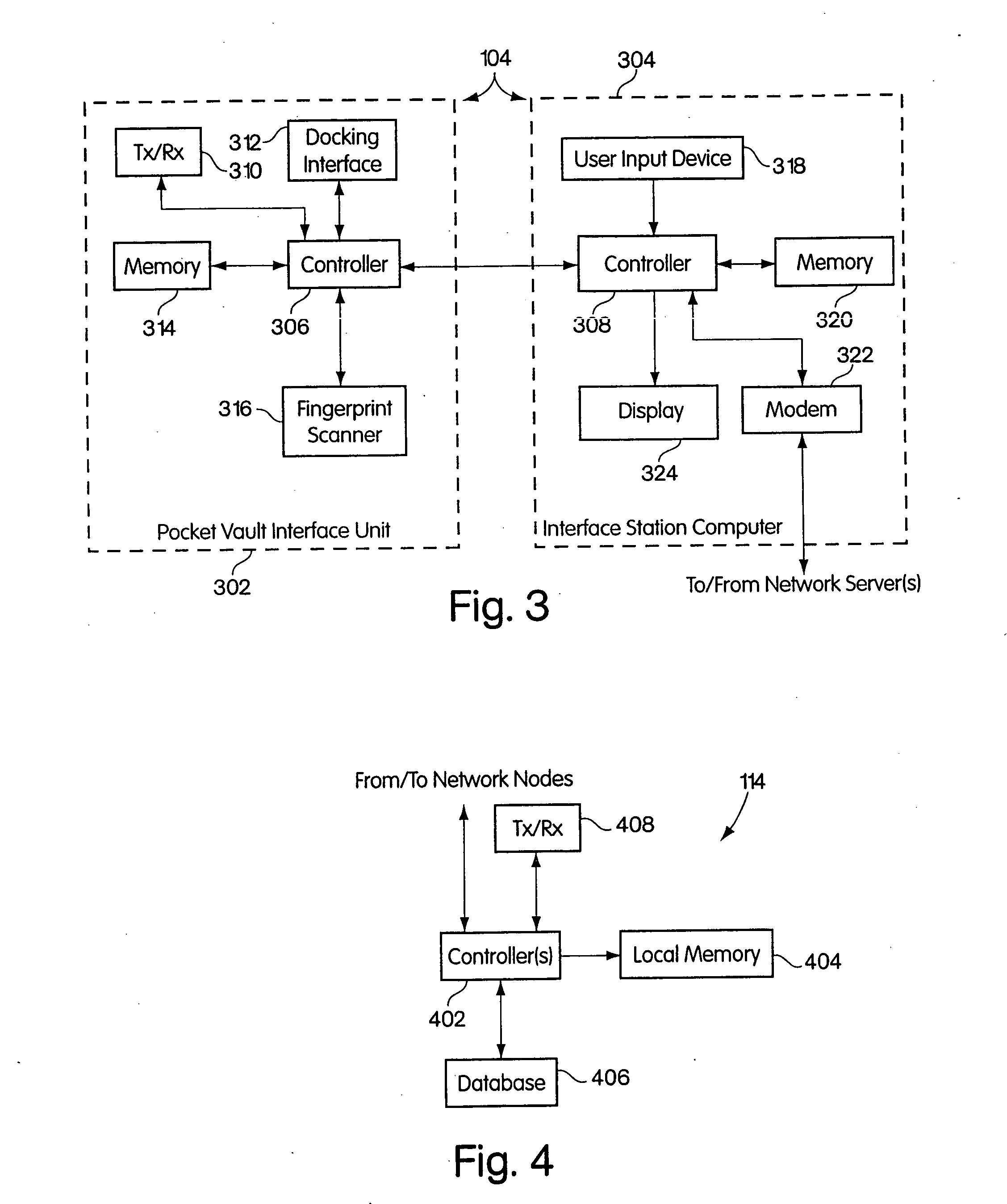

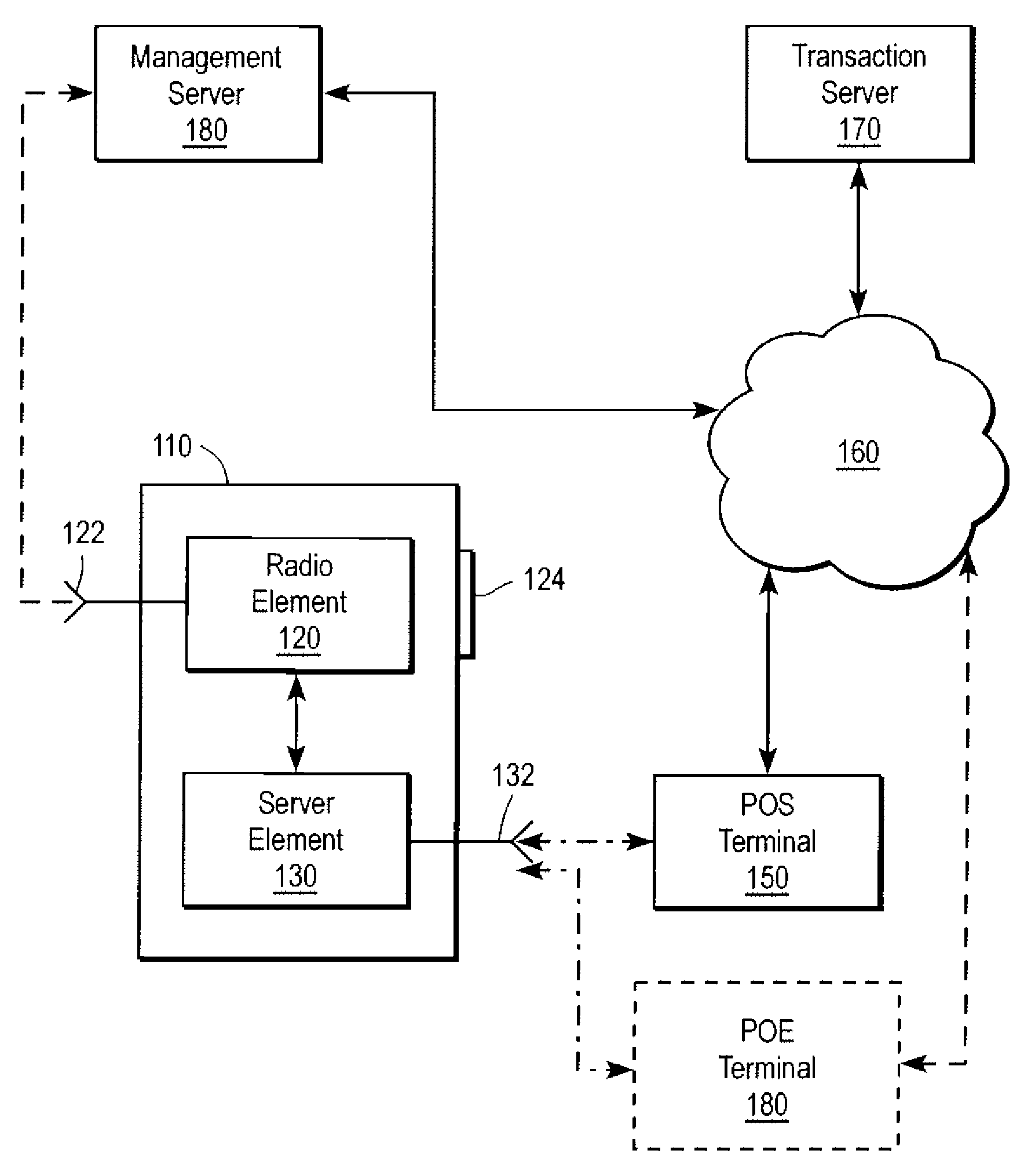

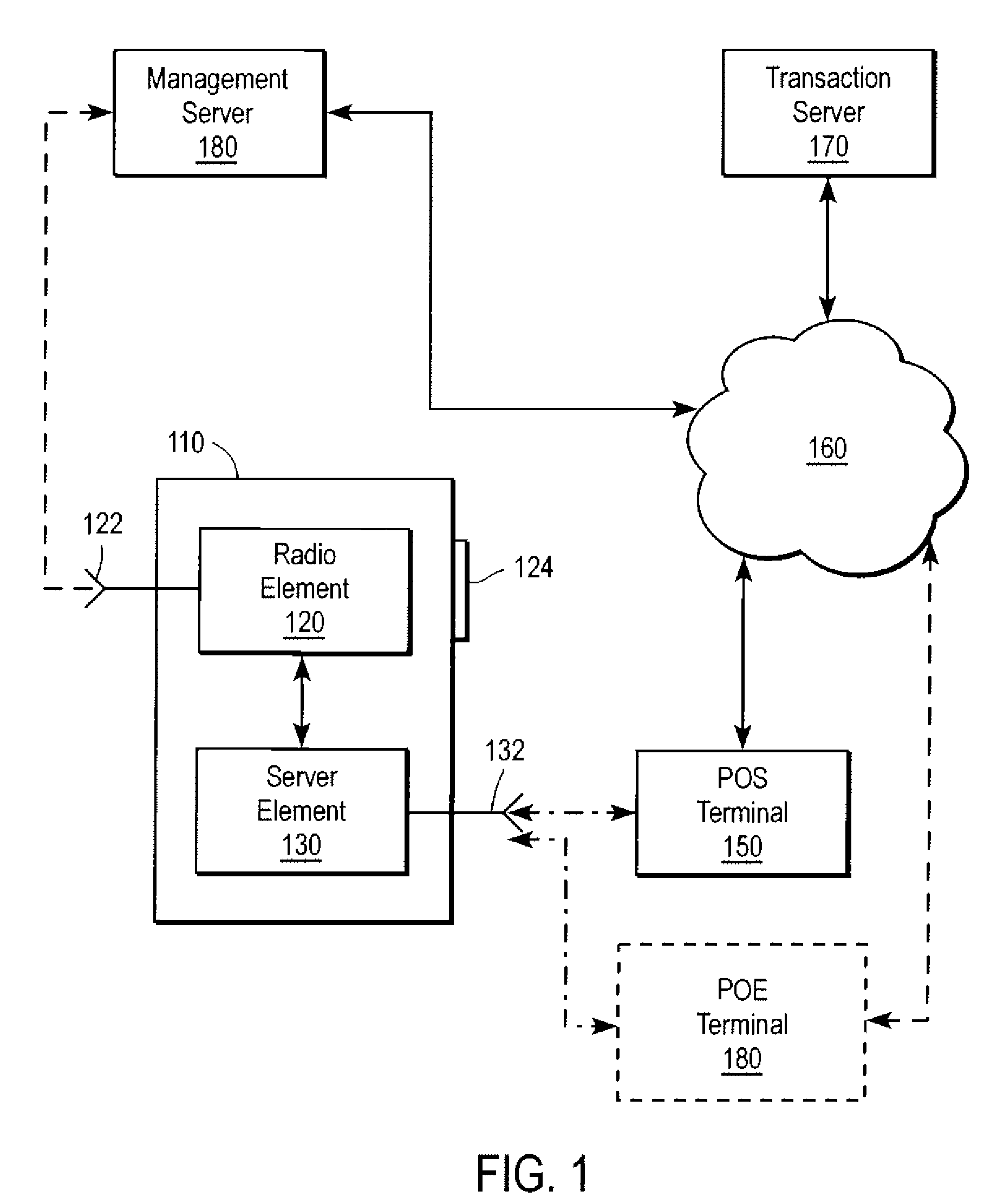

Method And Apparatus For Completing A Transaction Using A Wireless Mobile Communication Channel And Another Communication Channel

The present invention provides a method and apparatus for completing a transaction using a wireless mobile communication channel and another communication channel, particularly another communication channel that provides for near field radio channels (NFC), as well as other communication channels, such as Bluetooth or WIFI. The present invention also provides a method of completing a transaction in which a management server assists a transaction server and a point of sale terminal in forwarding transaction information to a hand-held mobile device, with the transaction having originated from the hand-held mobile device. There is also provided a hand-held mobile device that wirelessly communicates between a secure element and a radio element that are associated with the hand-held mobile device.

Owner:FISHER MICHELLE

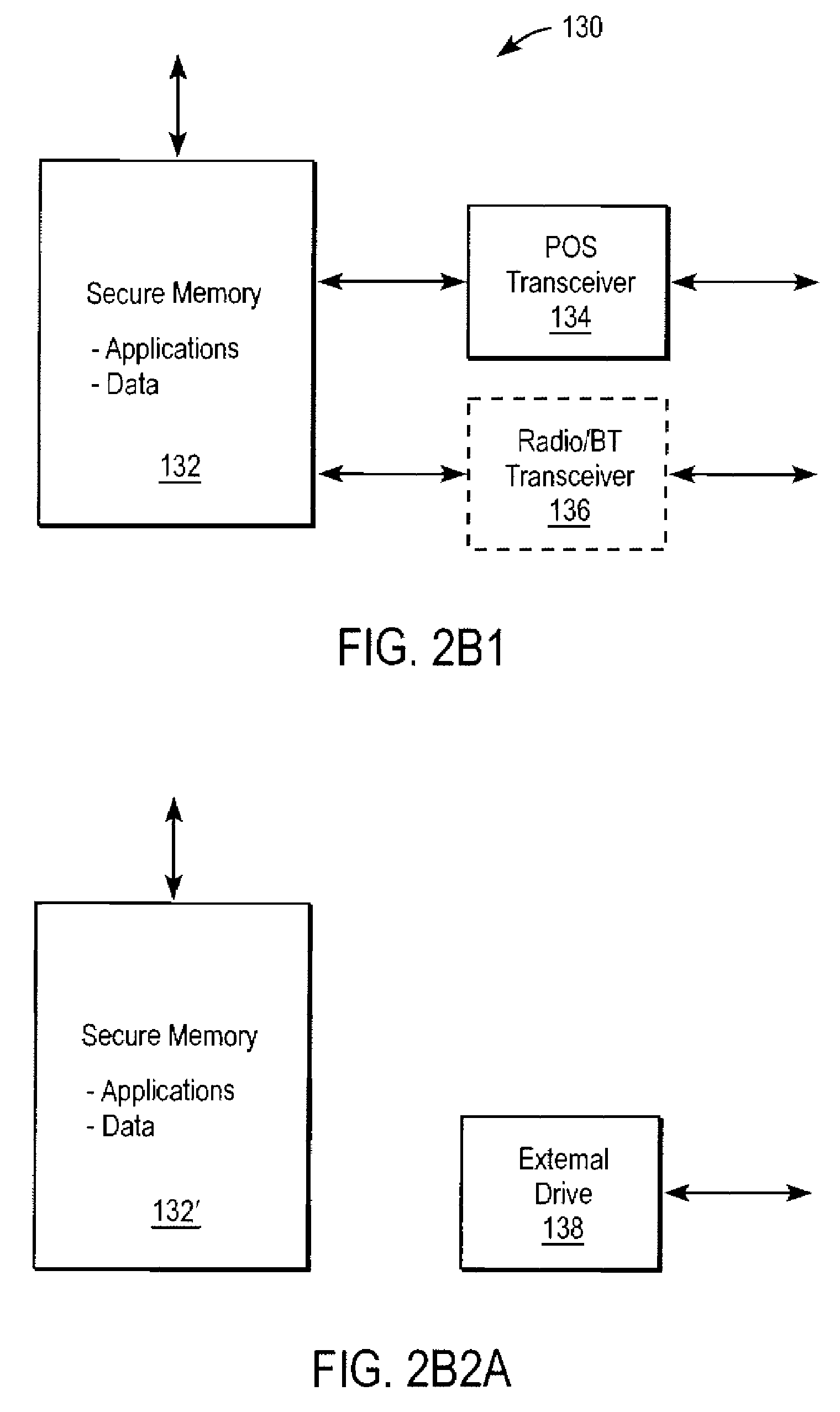

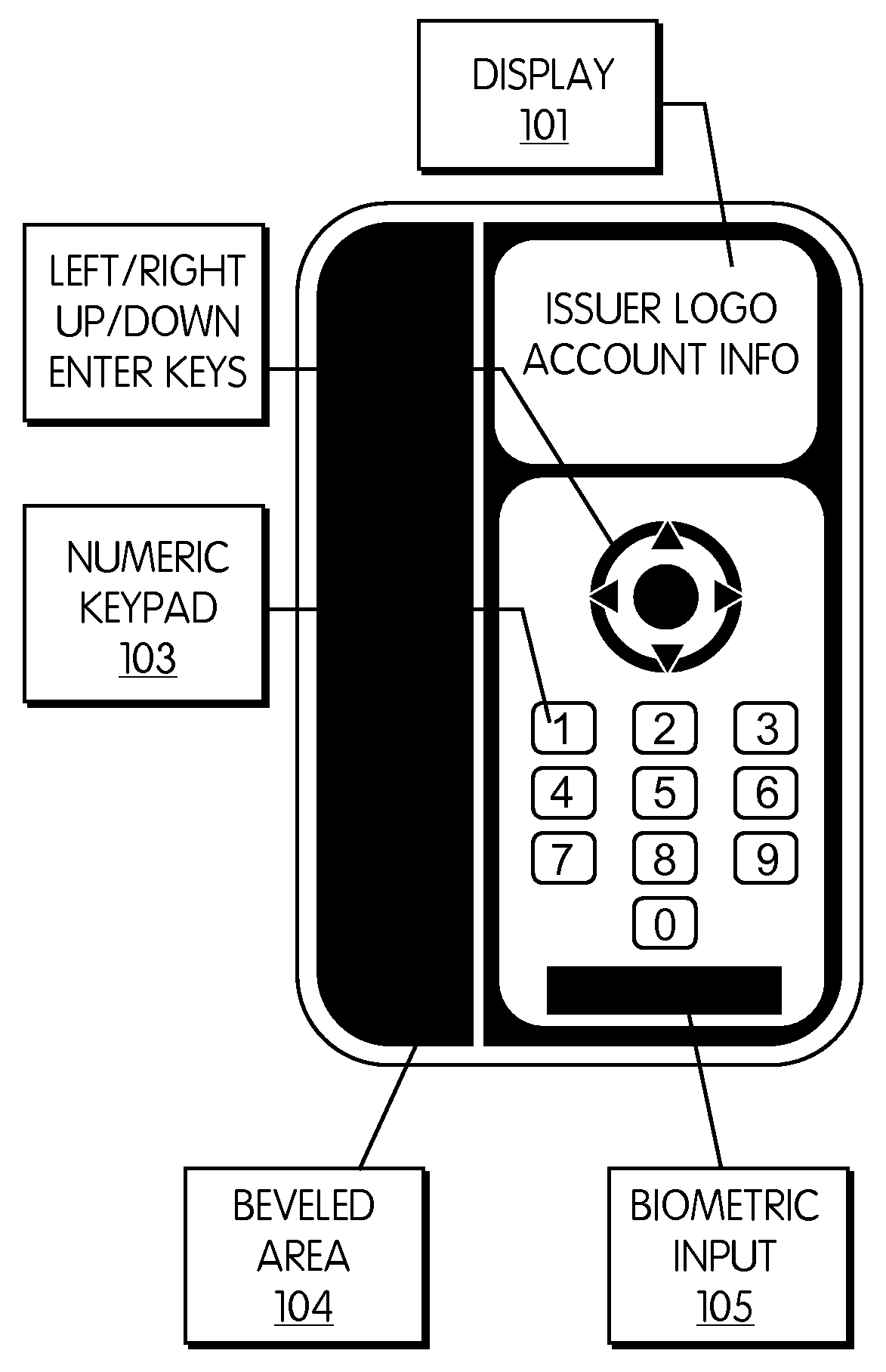

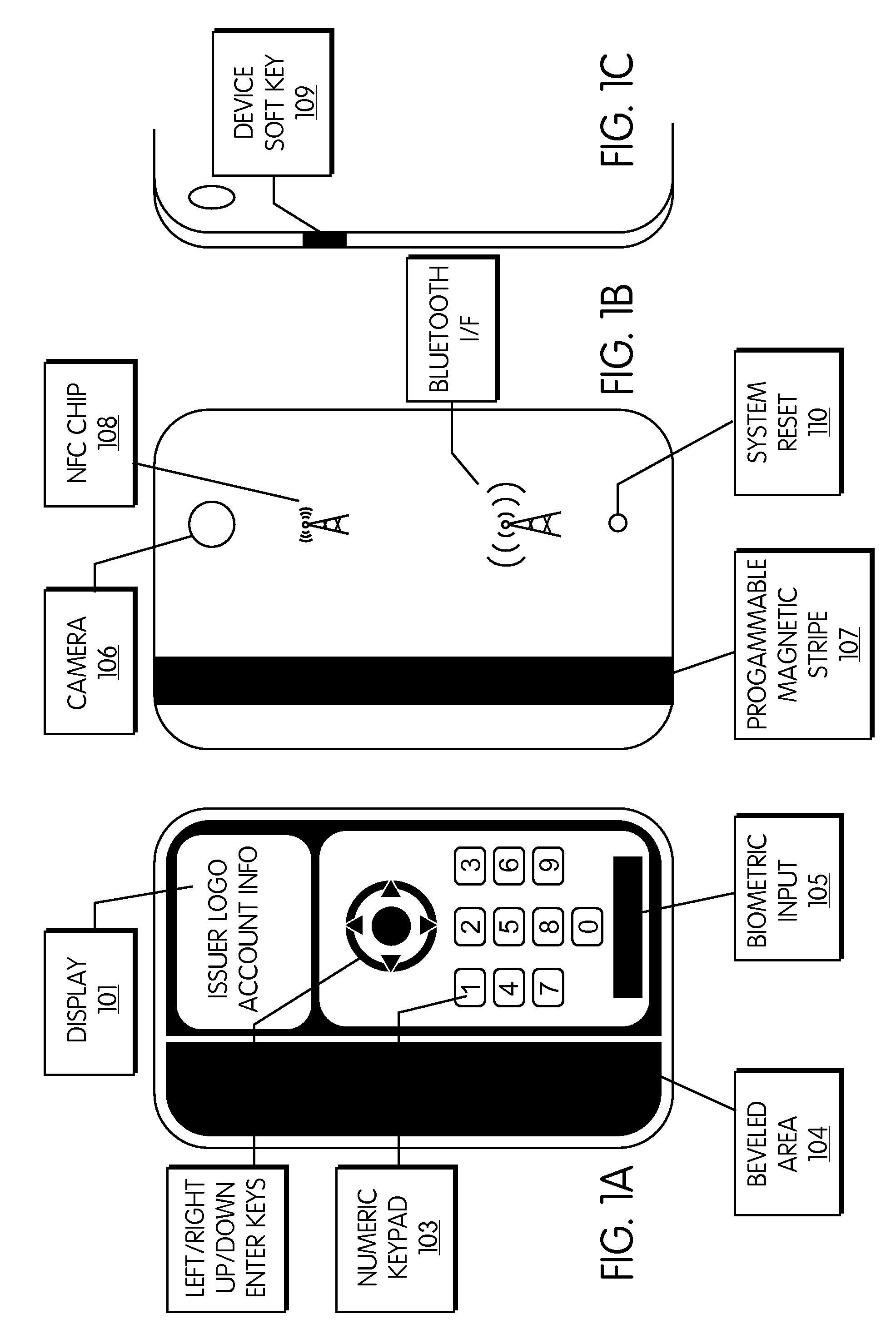

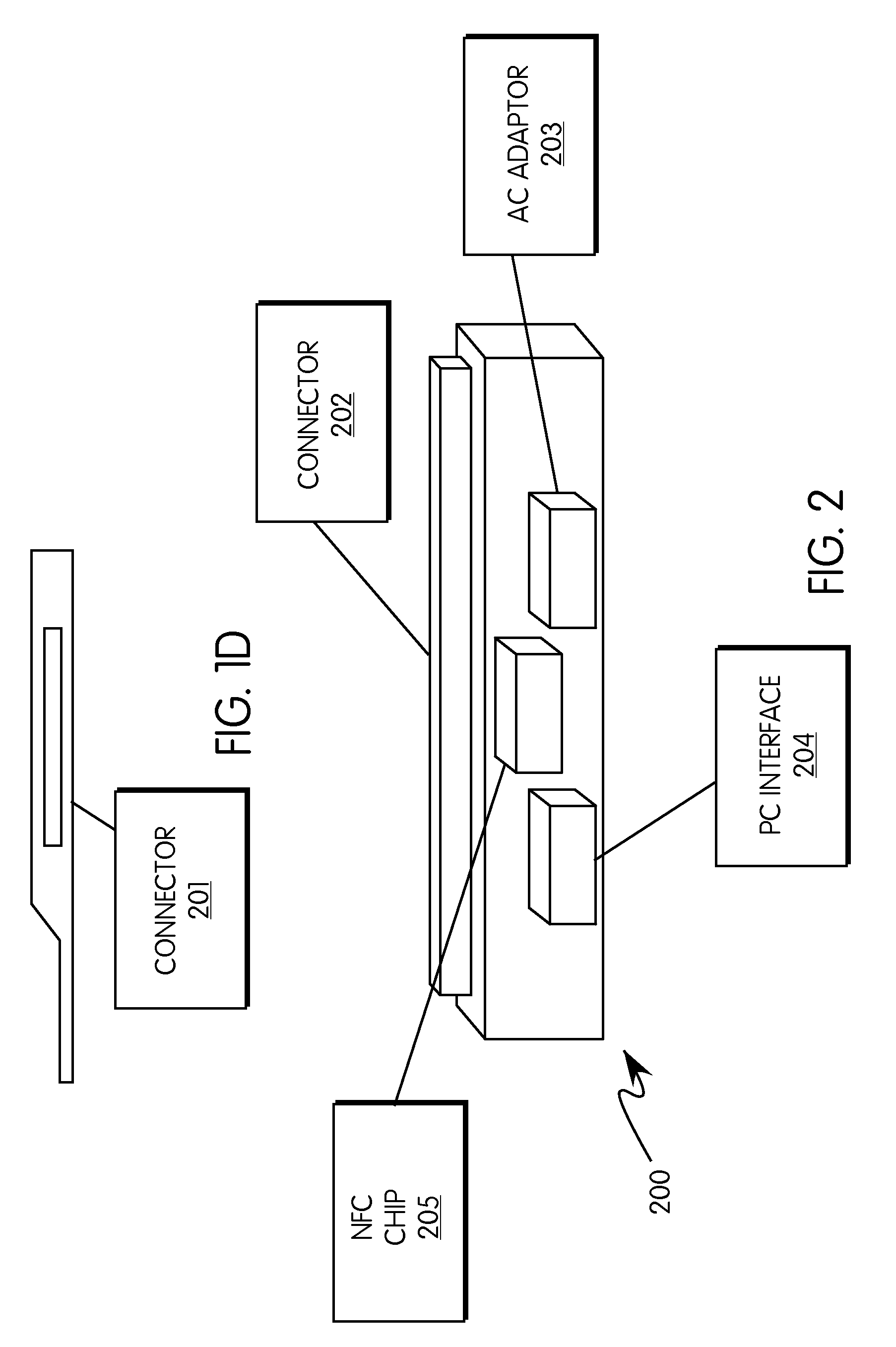

Point Of Sale Transaction Device With Magnetic Stripe Emulator And Biometric Authentication

InactiveUS20080126260A1Cost effectiveImprove security levelAcutation objectsPoint-of-sale network systemsData setComputer science

A handheld unit which is capable of emulating a plurality of smartcards or magnetic stripe cards. The unit has the capability of storing a plurality of data sets representing a plurality of accounts. The unit is equipped with an RF interface that can emulate a smartcard interface that is capable of communicating with smartcard readers at POS or ATM terminals, or anywhere else a smartcard may be utilized. The unit is also equipped with a programmable magnetic strip such that it can be used anywhere a magnetic stripe card can be swiped or inserted. The unit is equipped with a biometric sensor to positively verify an authenticated user.

Owner:X CARD HLDG

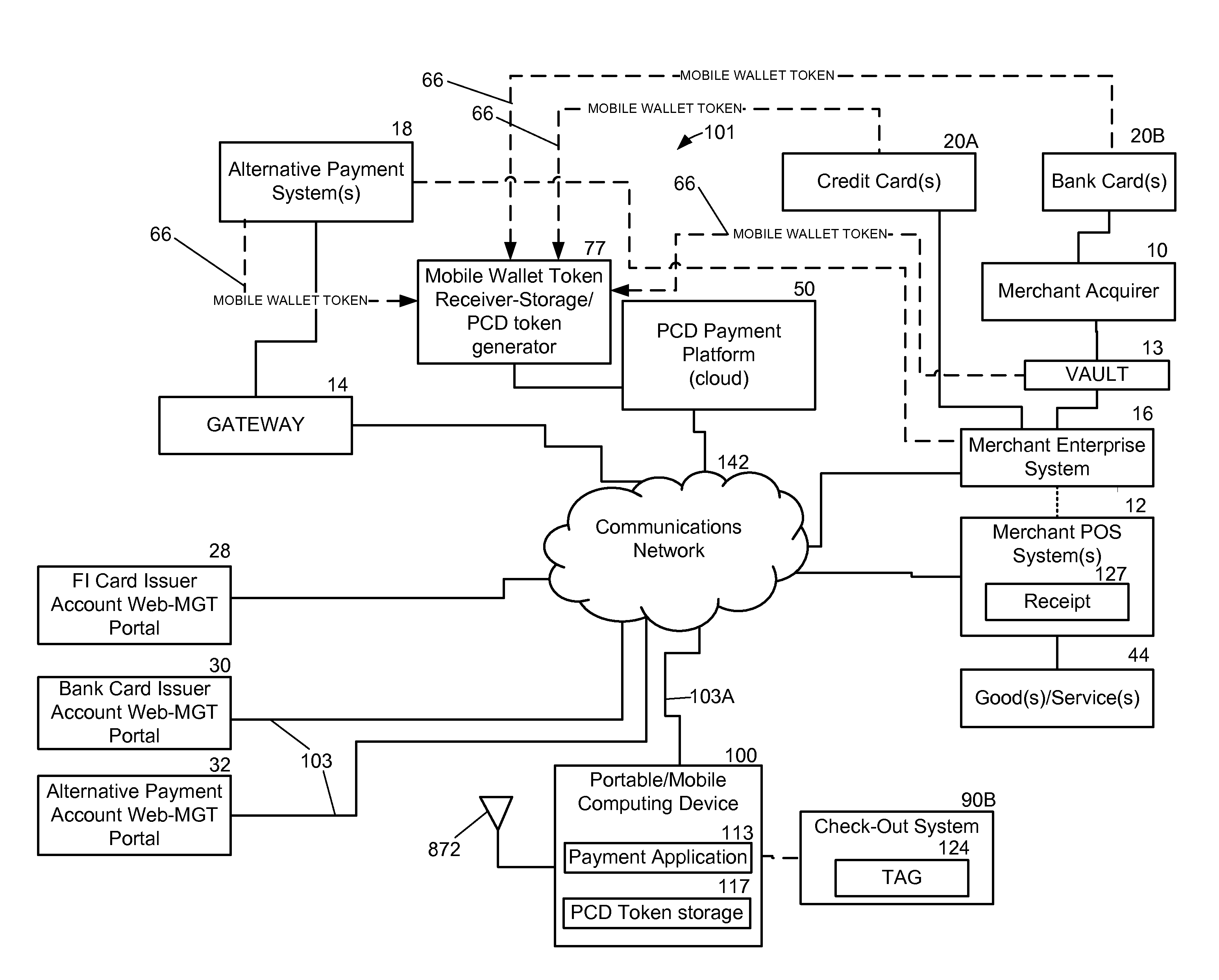

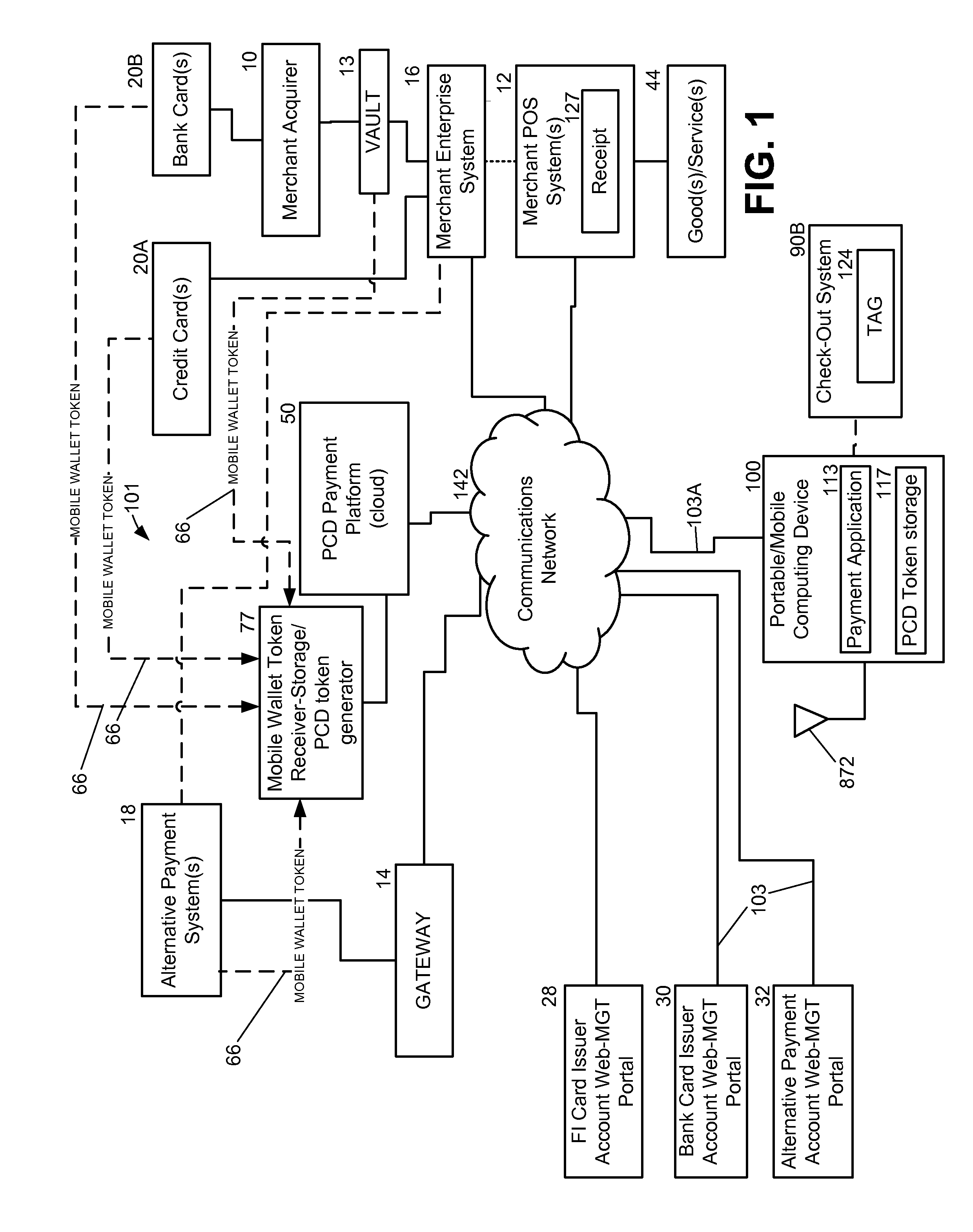

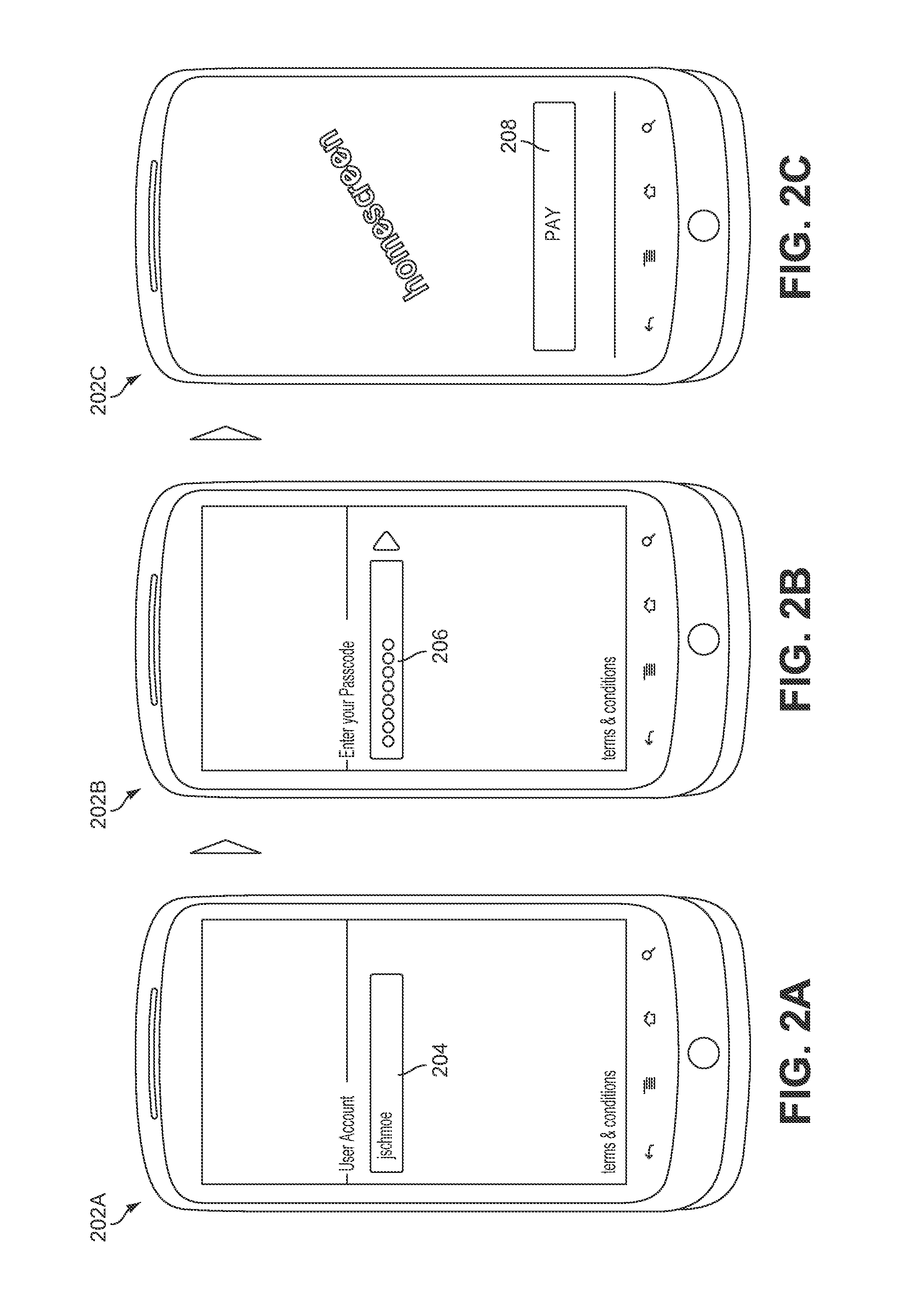

System and method for managing payment in transactions with a pcd

A system and method for managing payment in a transaction using a portable computing device (“PCD”) includes a mobile wallet token being received from an account issuing entity. Next, the mobile wallet token is stored in memory within a PCD payment platform (i.e., a cloud payment solution). A PCD token that corresponds with the mobile wallet token is generated by the PCD payment platform. The PCD token is transmitted over a communications network to a PCD. The mobile wallet token corresponds to at least one of: a credit card account, an alternative or non-traditional payment account, a stored value account, an account from a financial institution, and a merchant based card account. A mobile wallet token may be generated in response to receiving input from an on-line portal that future use of a payment account with a PCD is desired or in response to input received from a point-of-sale terminal.

Owner:QUALCOMM INC

System and method of making payments using an electronic device cover with embedded transponder

InactiveUS20050017068A1Improve standardsDevices with card reading facilityCash registersTransceiverElectronic identification

A changeable cover for an electronic device and method of using same in a payment system is provided. The cover has a transponder responsive to interrogation by an electric field. The cover provides an electronic identification number and other information in response to the interrogation signal. Also provided is a system for making payments, comprising at least one mobile station (4) which has an associated cover (100) for providing local data transfer. The system also comprises at least one point of sale terminal or the like, which has a second transceiver for providing data transfer.

Owner:RPX CORP

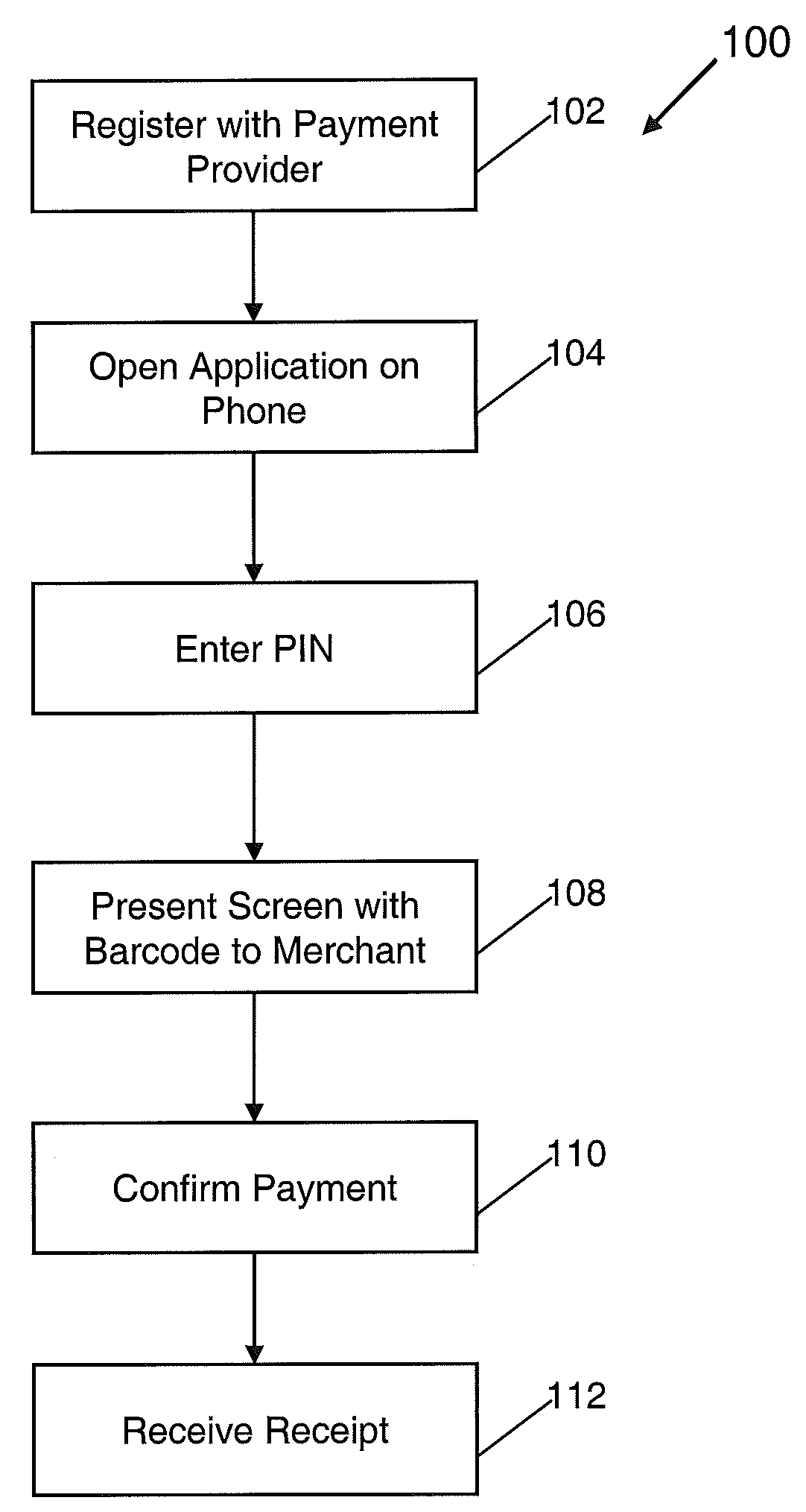

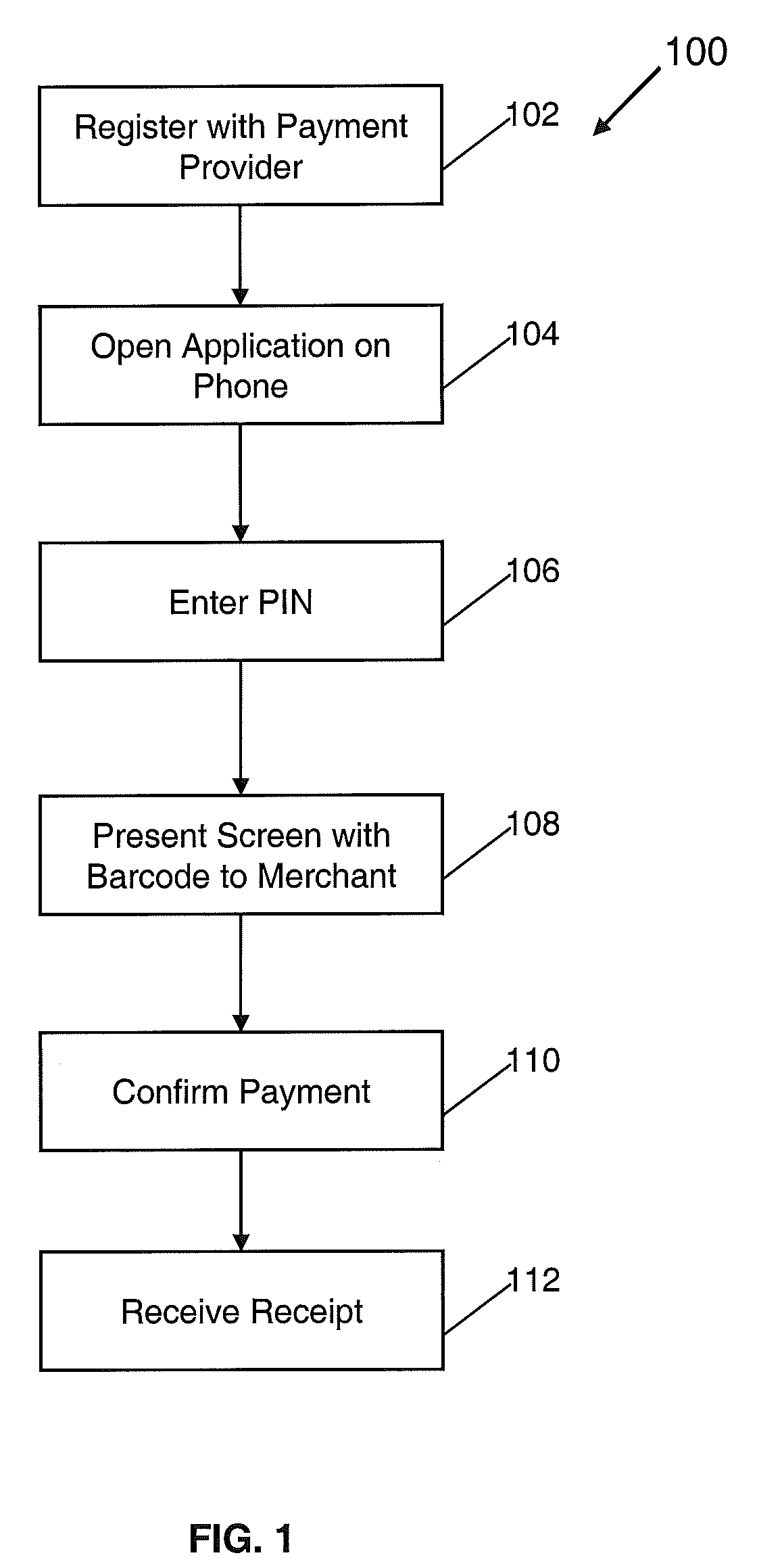

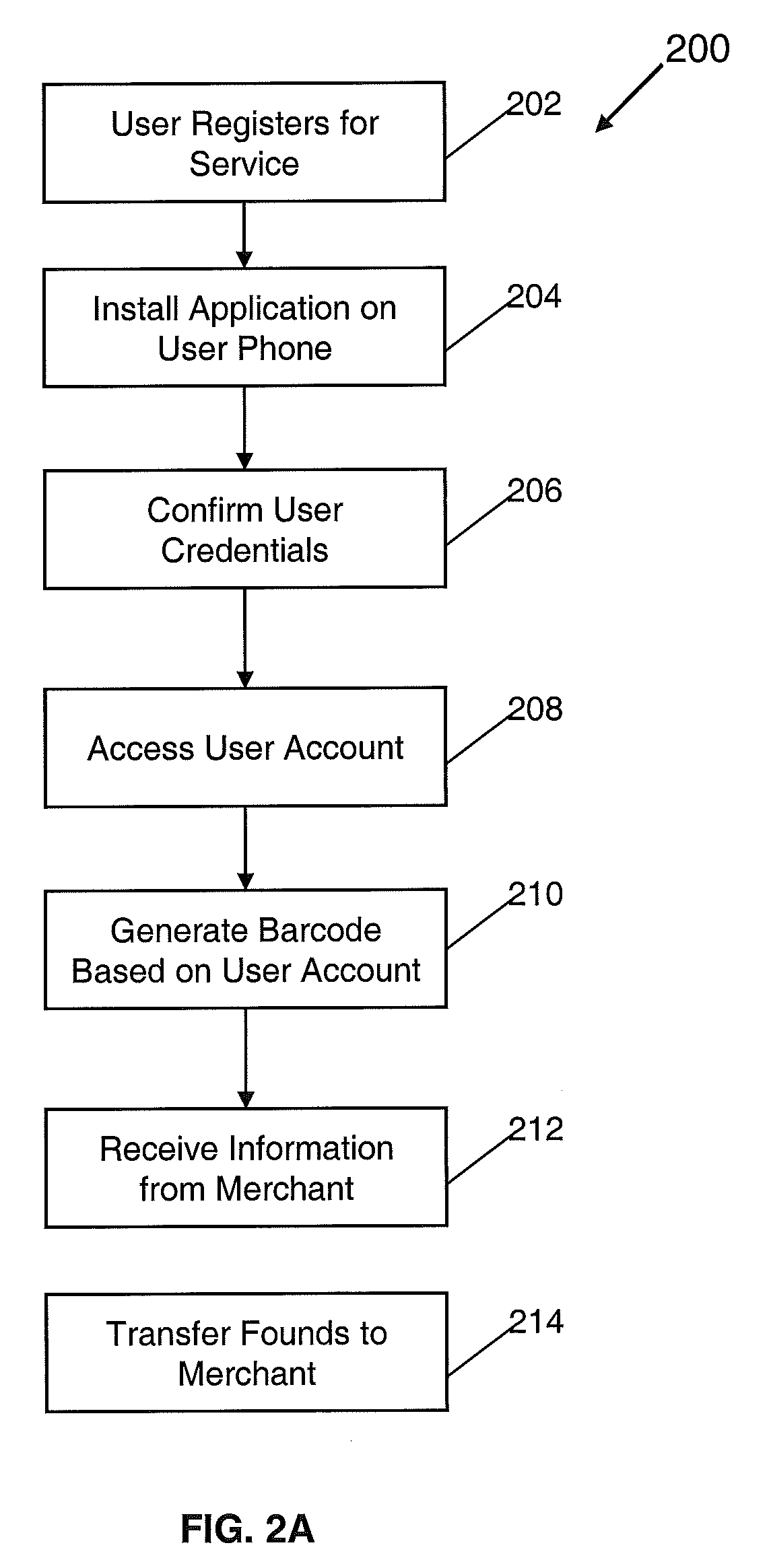

Mobile barcode generation and payment

ActiveUS20100138344A1Easily and safely payIncrease volumeFinanceBuying/selling/leasing transactionsPaymentDisplay device

An application on user's mobile device (having a display screen) generates a one-time use and time-limited barcode on the display when the user enters a PIN. The barcode can be scanned to make purchases at a point of sale (POS).

Owner:PAYPAL INC

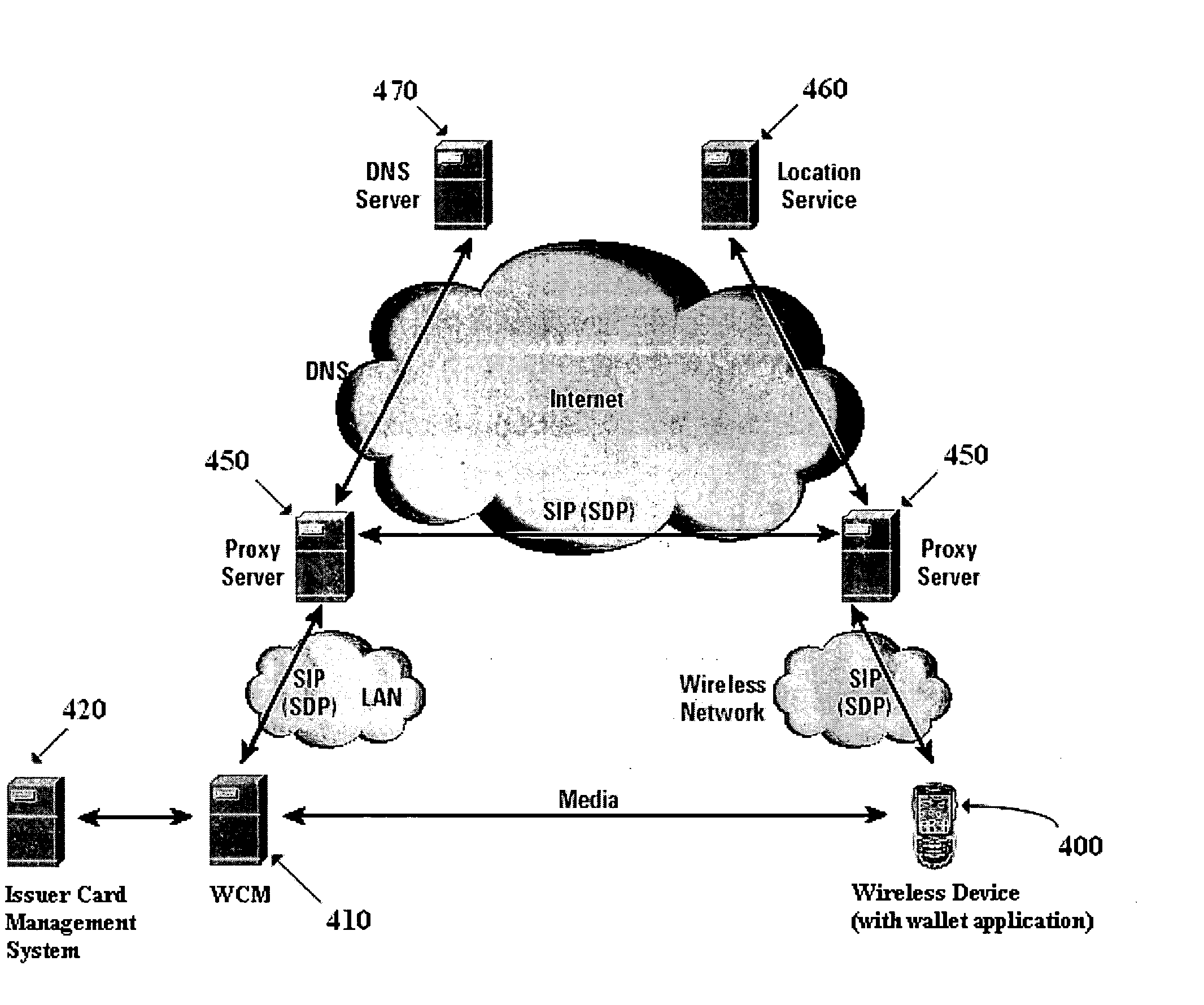

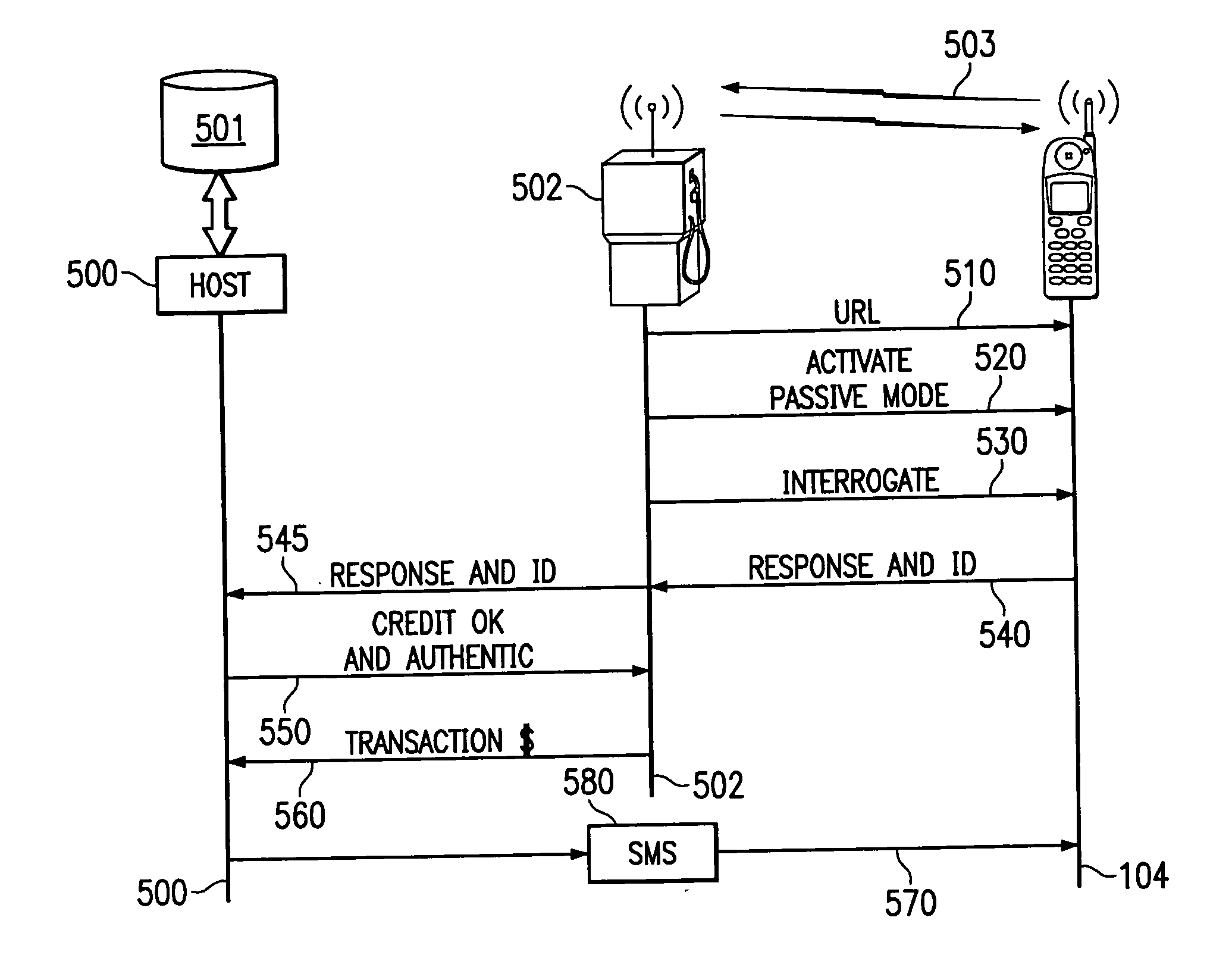

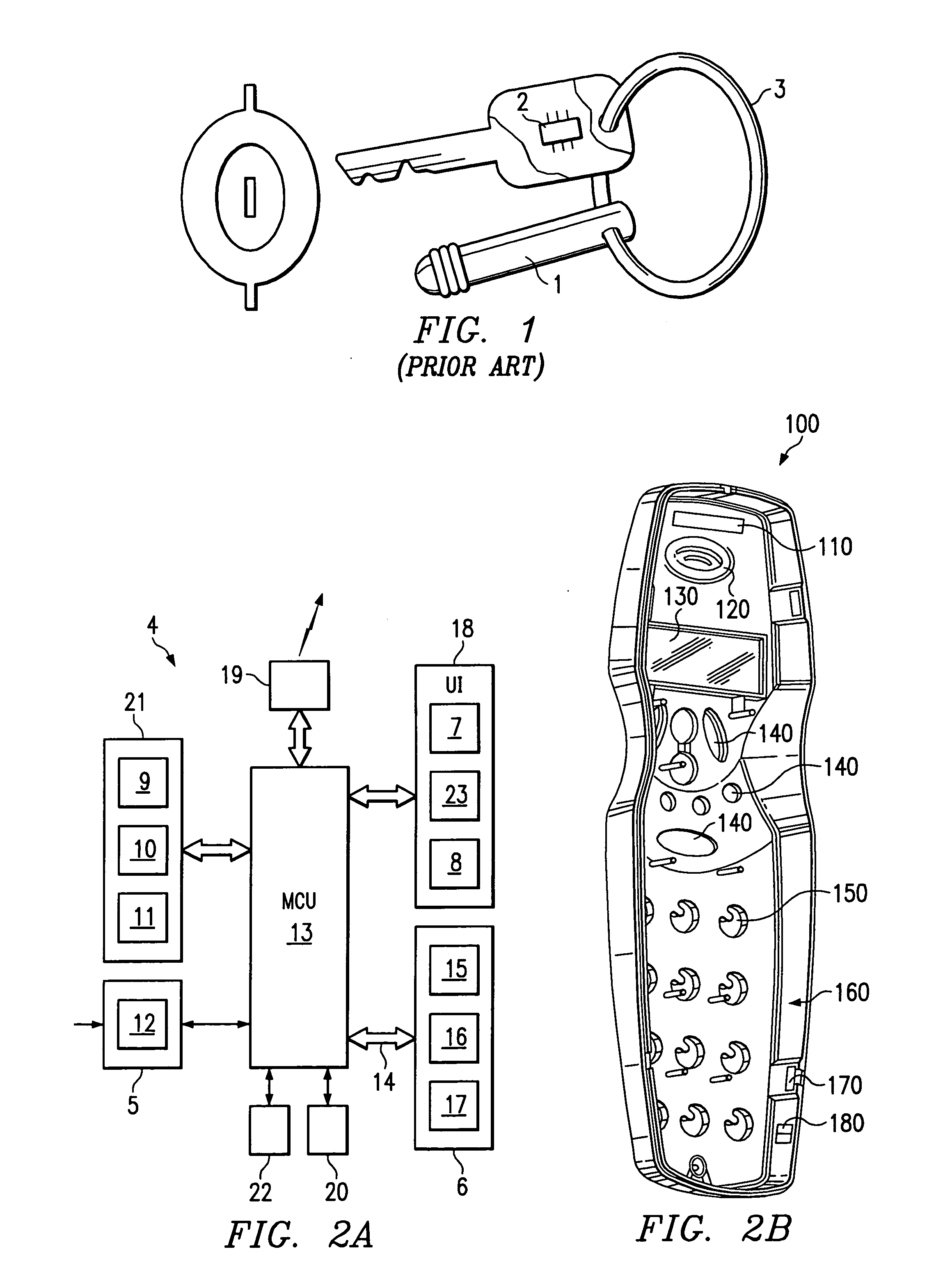

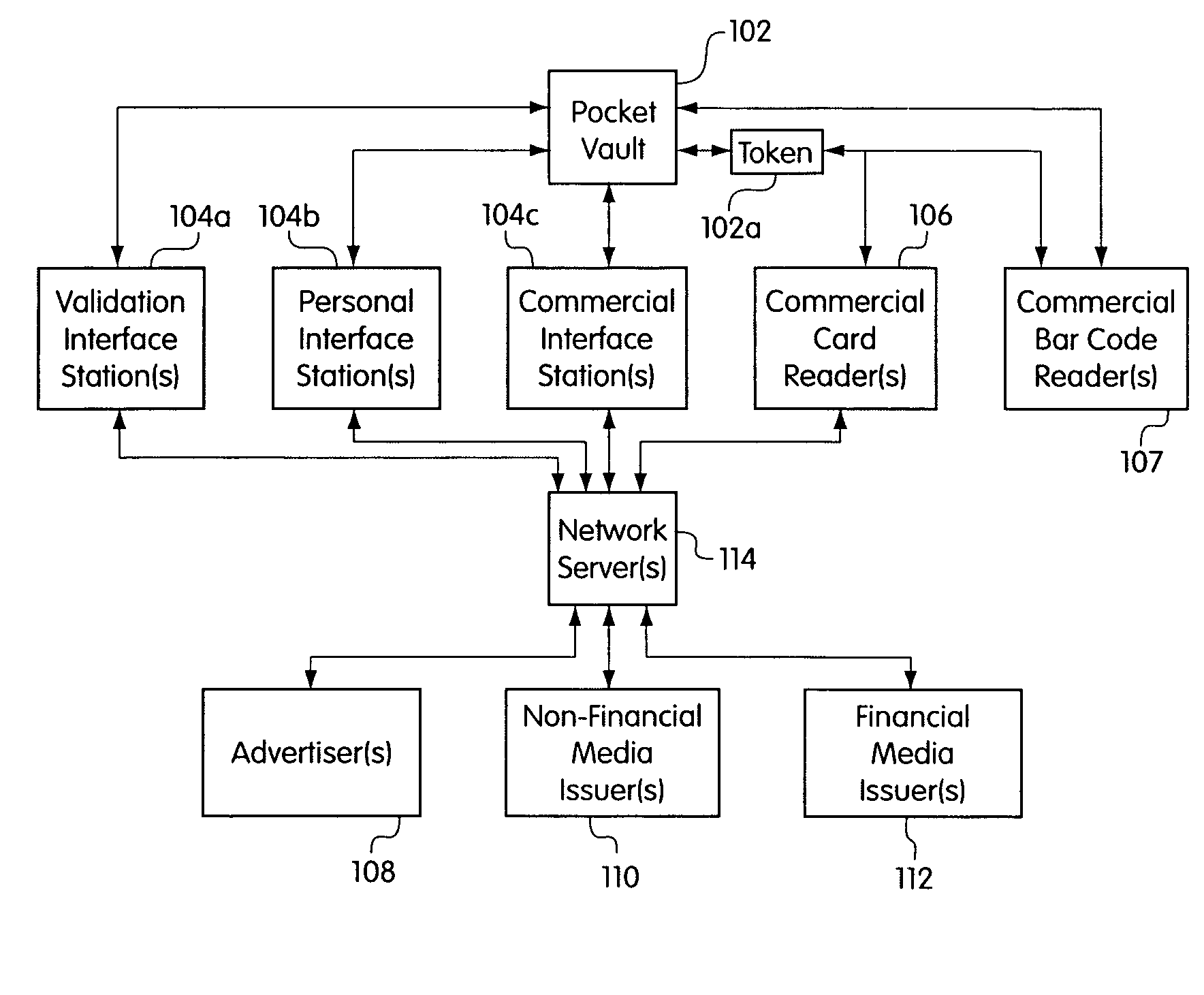

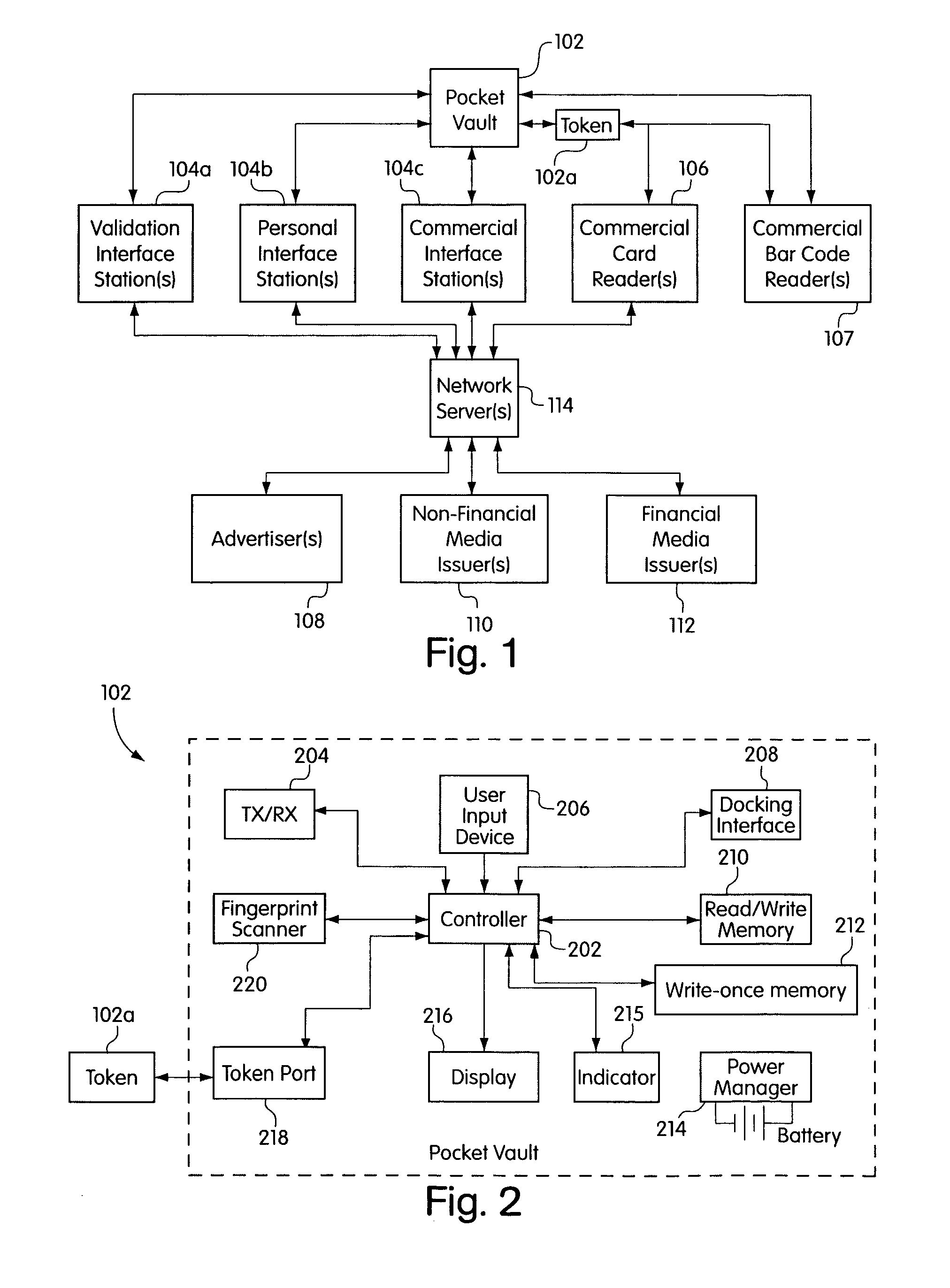

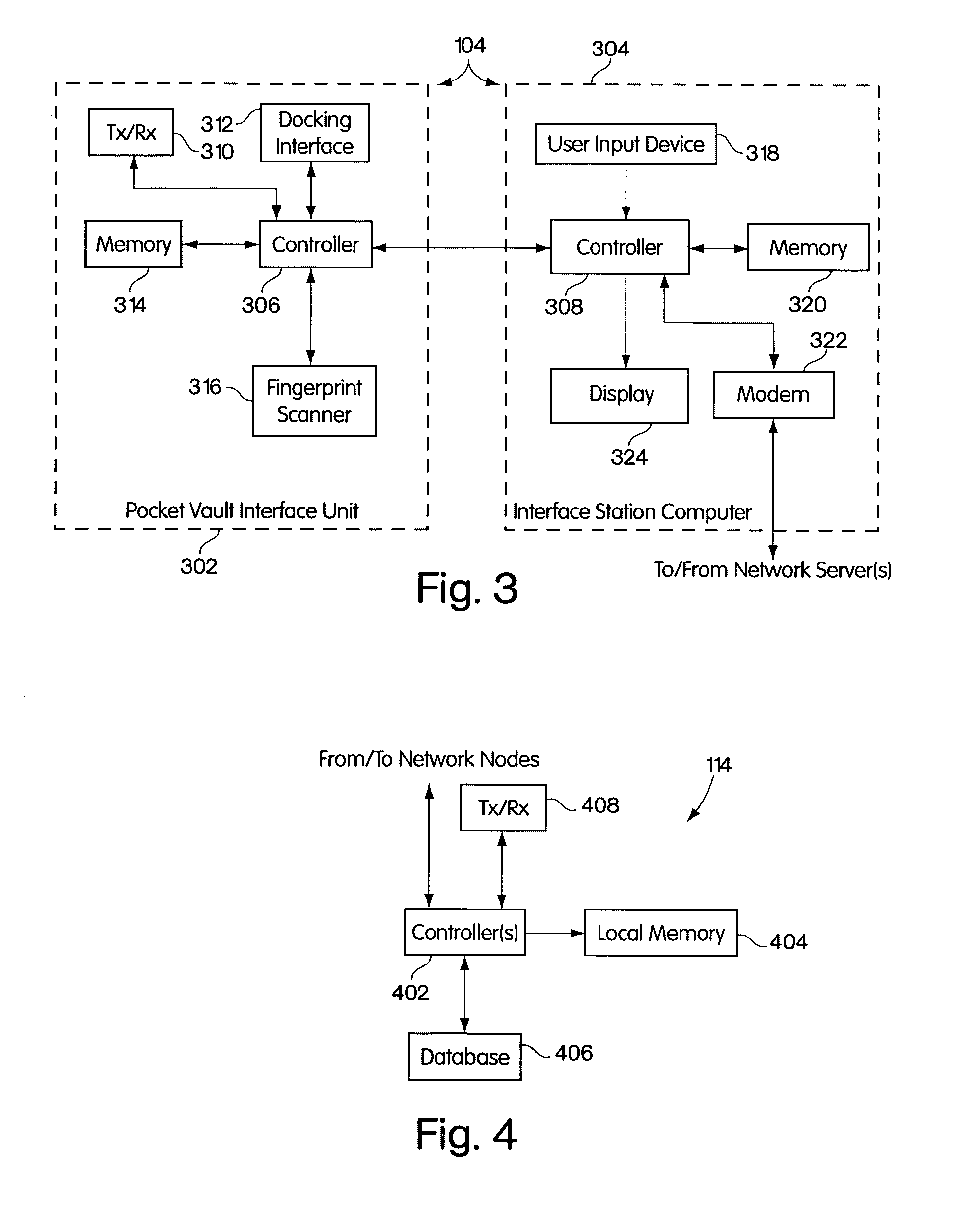

Method and apparatus for managing credentials through a wireless network

ActiveUS8700729B2Convenient and efficient and secure distributionNear-field in RFIDData switching by path configurationCredit cardSystems design

A novel system and methodology for conducting financial and other transactions using a wireless device. Credentials may be selectively issued by issuers such as credit card companies, banks, and merchants to consumers permitting the specific consumer to conduct a transaction according to the authorization given as reflected by the credential or set of credentials. The preferred mechanism for controlling and distributing credentials according to the present invention is through one or more publicly accessible networks such as the Internet wherein the system design and operating characteristics are in conformance with the standards and other specific requirements of the chosen network or set of networks. Credentials are ultimately supplied to a handheld device such as a mobile telephone via a wireless network. The user holding the credential may then use the handheld device to conduct the authorized transaction or set of transactions via, for example, a short range wireless link with a point-of-sale terminal.

Owner:SAMSUNG ELECTRONICS CO LTD

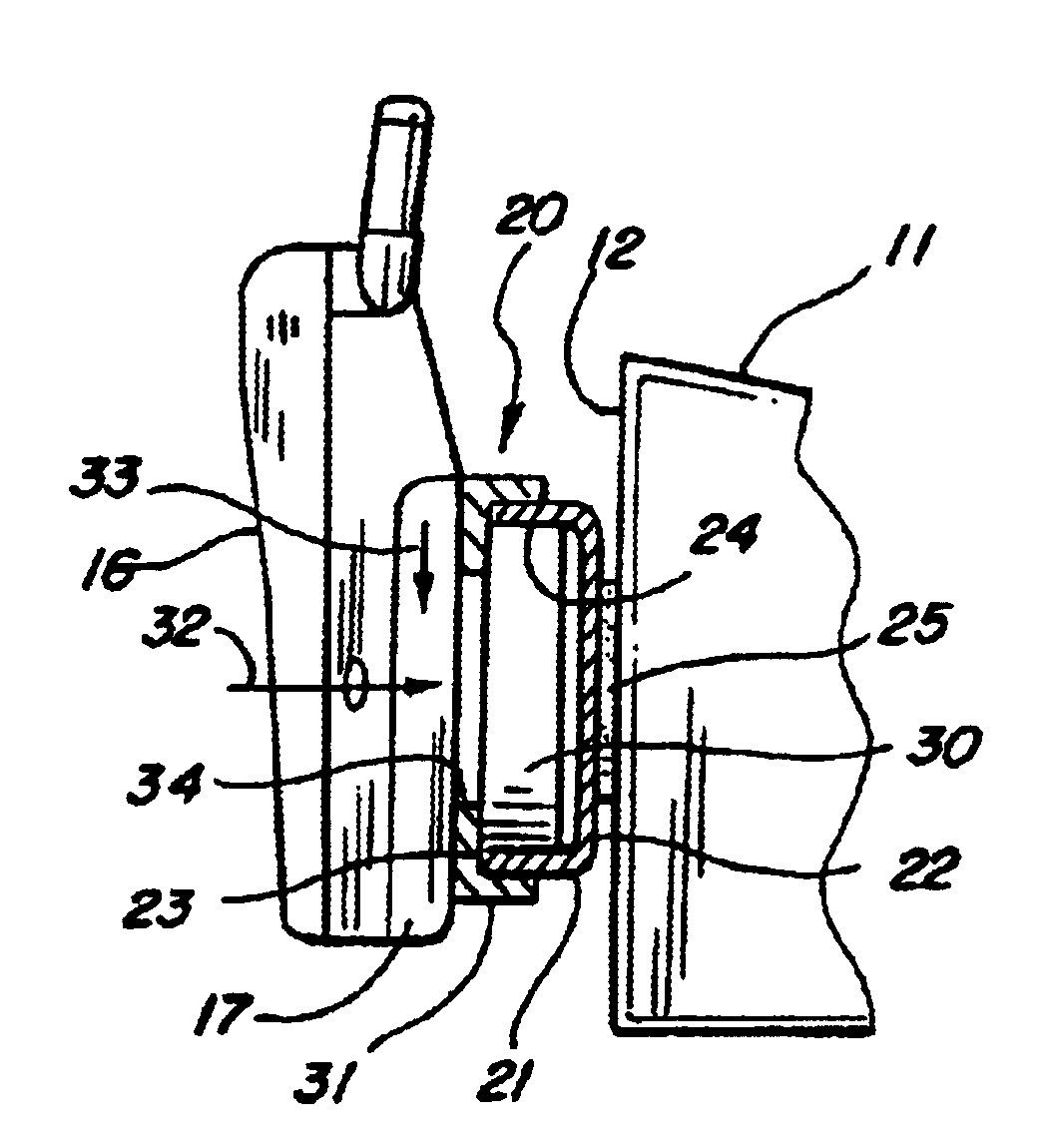

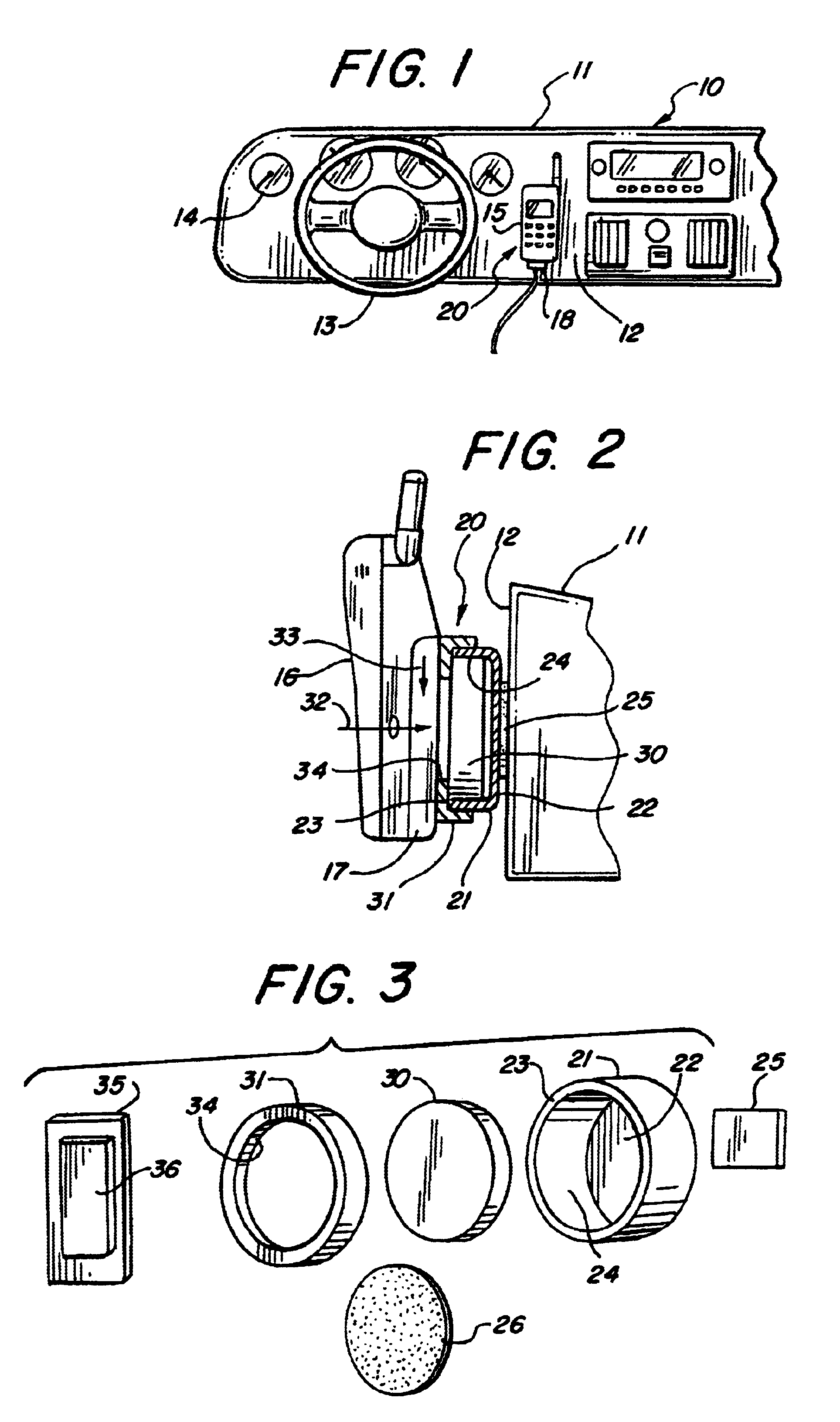

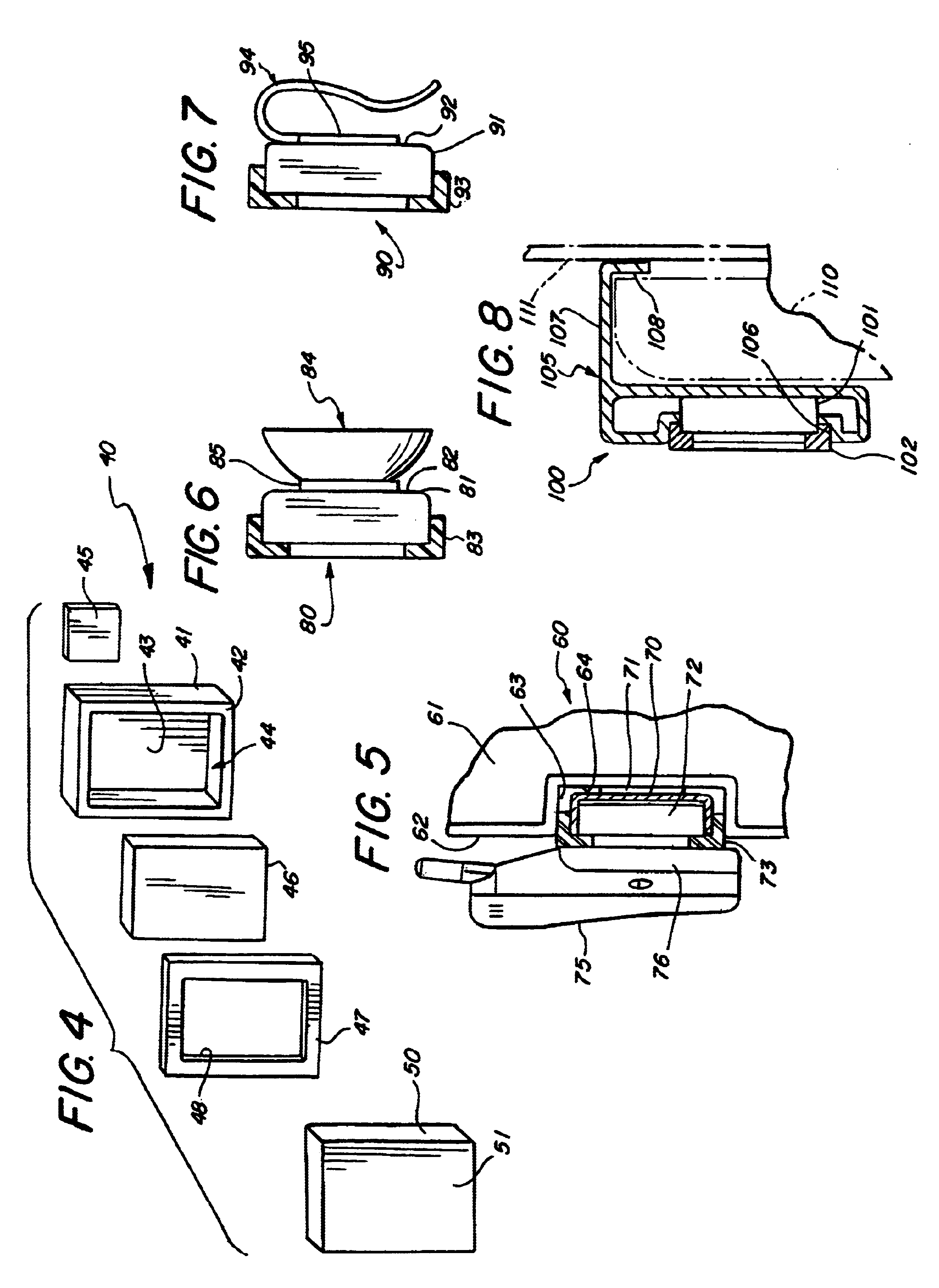

Magnetic holder for cell phones and the like

A magnetic holder for cell phones includes a cup formed of a ferromagnetic material or the like within which a magnet is supported. The rear surface of the cup includes a double-sided adhesive pad to provide attachment of the cup to a vehicle dashboard surface or the like. The cup concentrates the force of the magnet along the frontal edges thereof. A friction ring encircles the frontal edges of the cup to provide enhanced retention of a cell phone secured to the cup by magnetic attraction between the internal magnet and the cell phone battery or other metallic portion thereof. Alternate embodiments are shown which provide different shapes of cup and magnet and which provide differing attachments such as suction cups or belt clips for retaining the magnetic holder. In a further alternate embodiment, the packaging provided for the cup holder is constructed to facilitate the multiple display of the a plurality of cup holders and packages in typical point of sale environment.

Owner:RED APPLE

Method of making secure electronic payments using communications devices and biometric data

ActiveUS20080040274A1Provide securityEnabling useFinancePoint-of-sale network systemsPaymentBiometric data

Methods and systems for carrying out financial transactions include creating unique aliases for payment instrument having associated identification numbers, associating the created aliases to the payment instruments and enabling consumer use of the aliases to carry out financial transactions. Various special point-of-sale devices may be employed to carry out the financial transactions.

Owner:UZO CHIJIOKE CHUKWUEMEKA

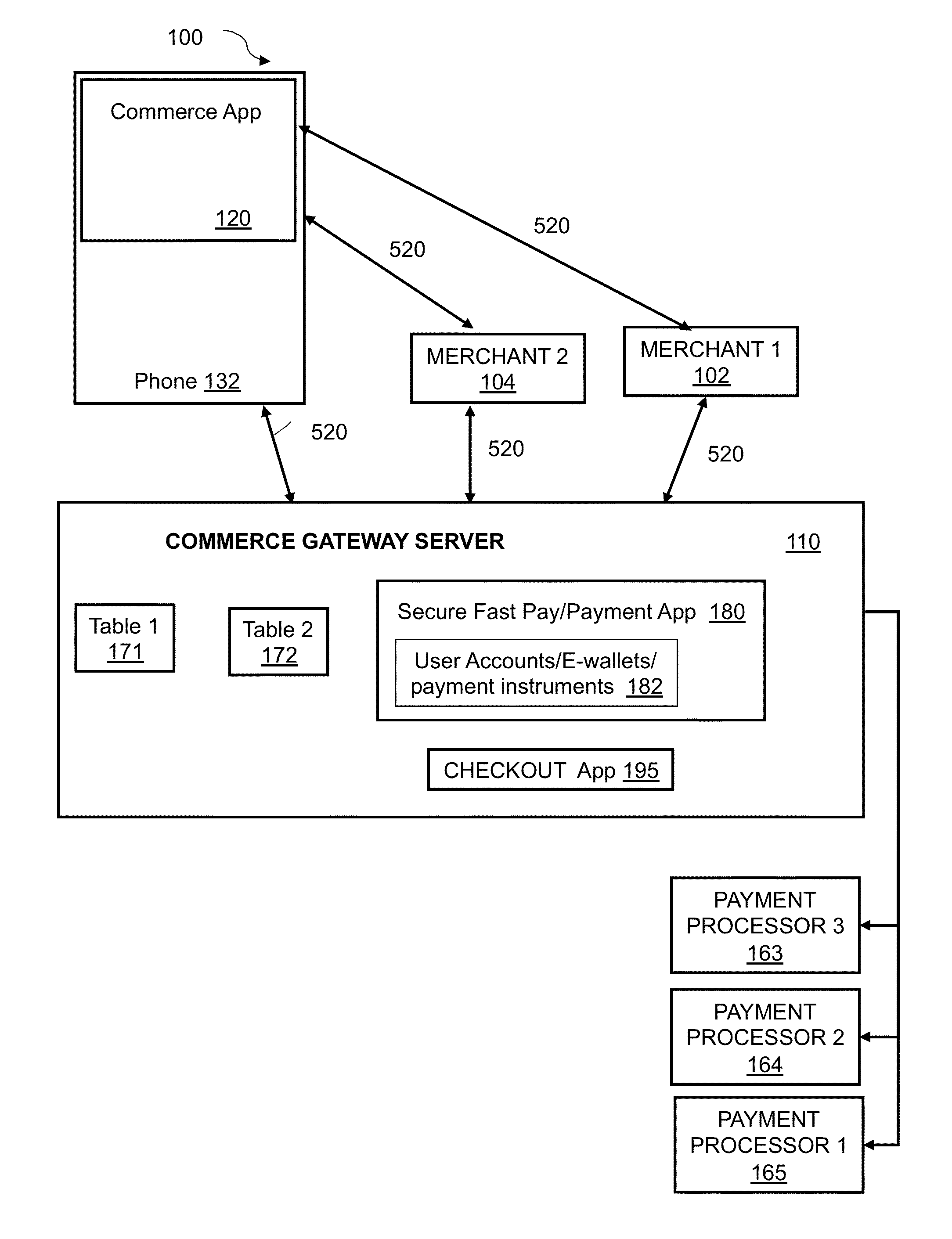

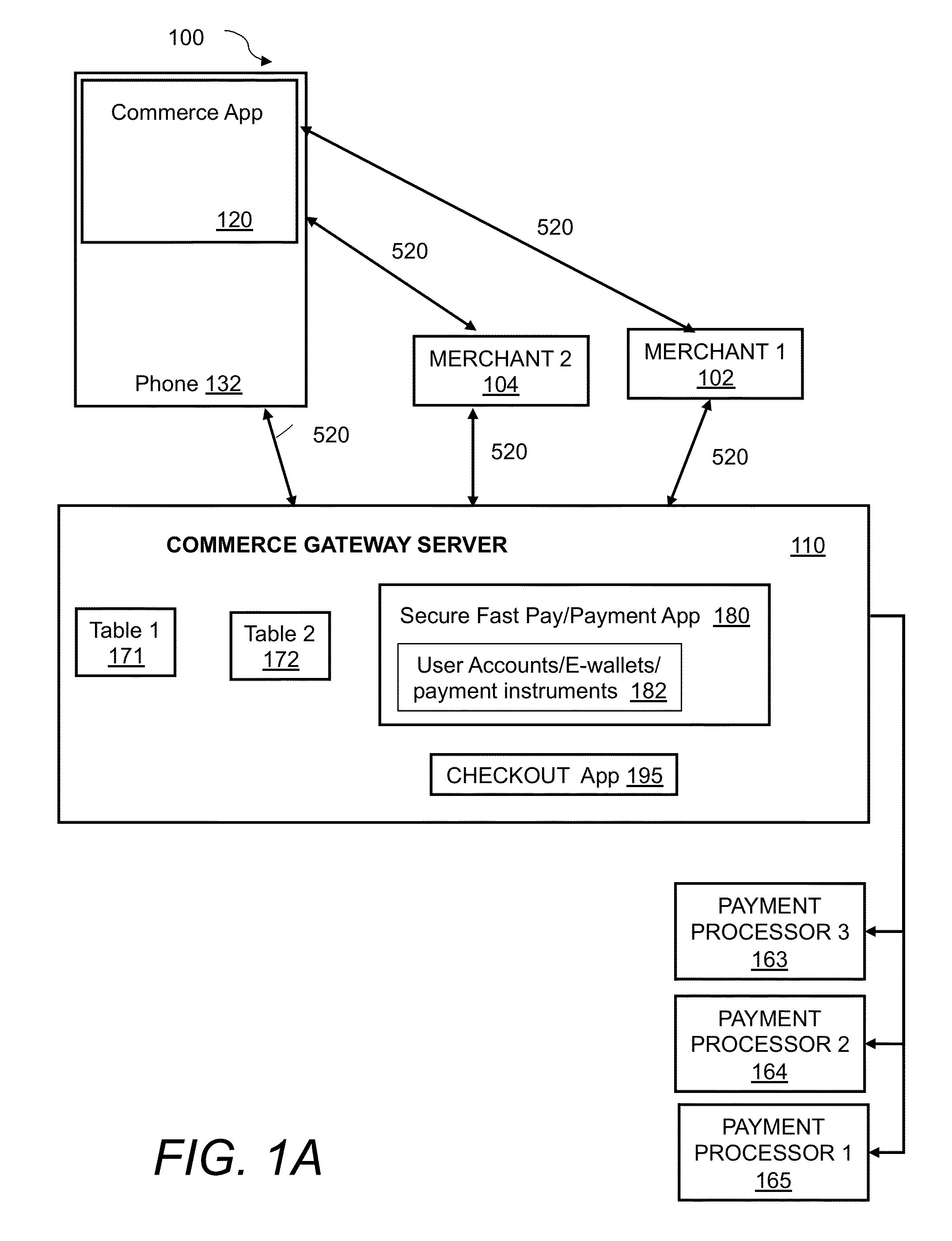

System and method for incorporating one-time tokens, coupons, and reward systems into merchant point of sale checkout systems

ActiveUS20130054336A1Convenient checkout experienceMore dataHand manipulated computer devicesDiscounts/incentivesPaymentReward system

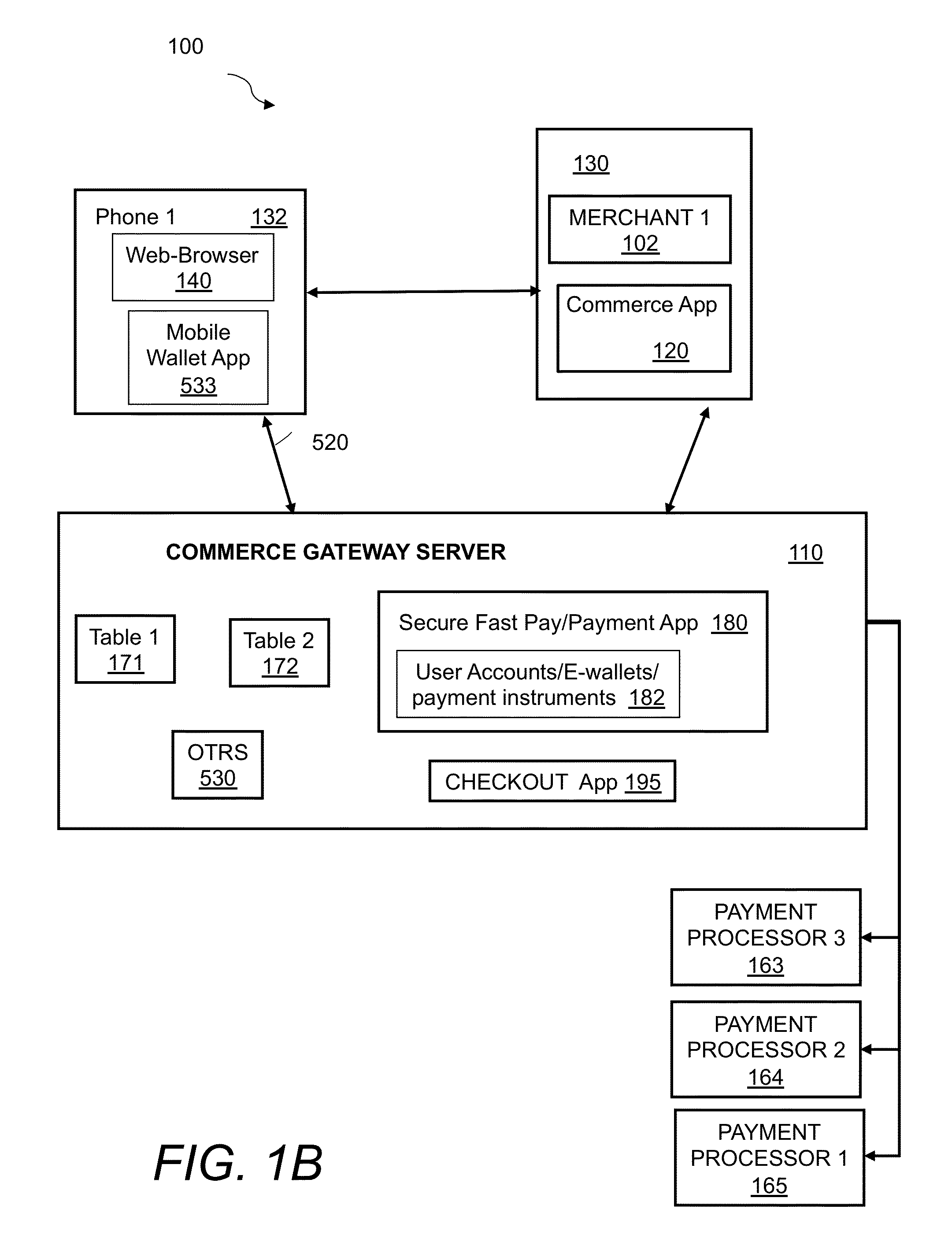

A method for incorporating one-time-tokens, coupon and reward systems in conjunction with merchants' POS checkout systems in the physical or virtual environments includes providing a consumer computing device comprising an electronic wallet application, providing a One-time Token Redemption System(OTRS) and user electronic wallet accounts, logging into a user electronic wallet account through the electronic wallet application, sending a request for a one-time token valid for a specified time interval and then forwarding the request for the one-time token to the OTRS and upon approval sending the requested one-time token from the OTRS to the electronic wallet application. Next, presenting and entering the one-time token into a merchant point of sale checkout system within the specified time interval via the consumer computing device, sending the entered one-time token to a checkout application, and then processing payment via a secure payment application.

Owner:INGENICO INC

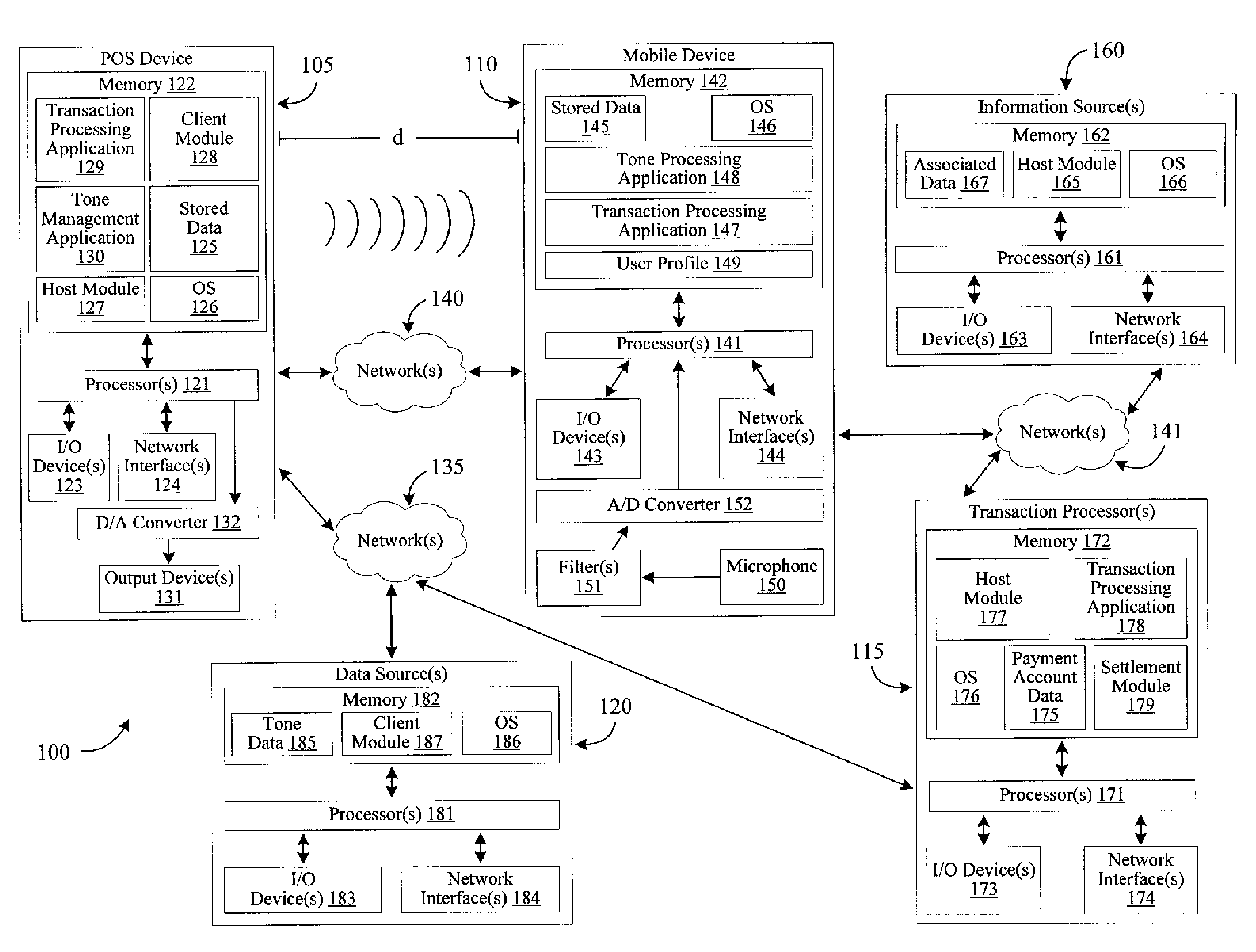

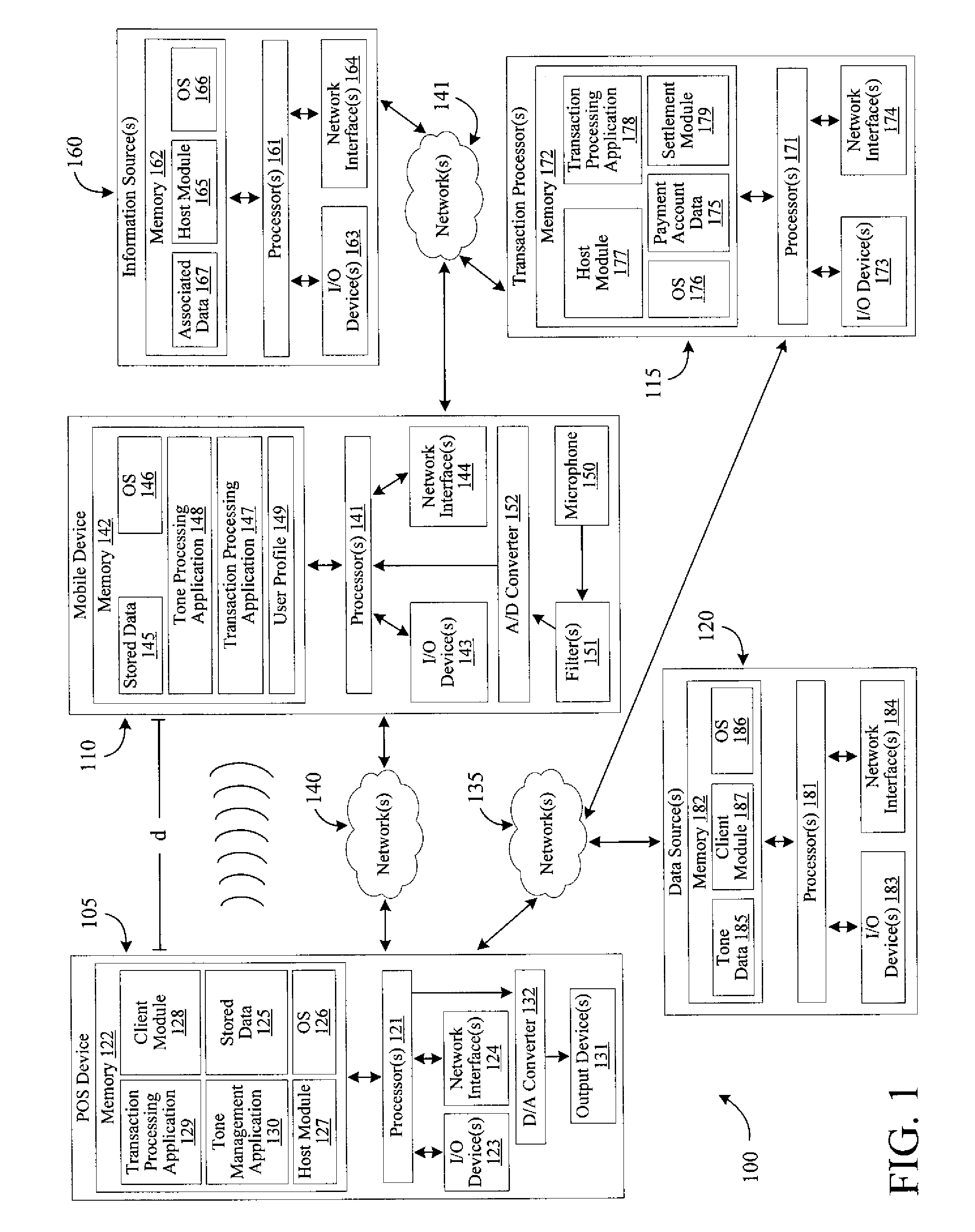

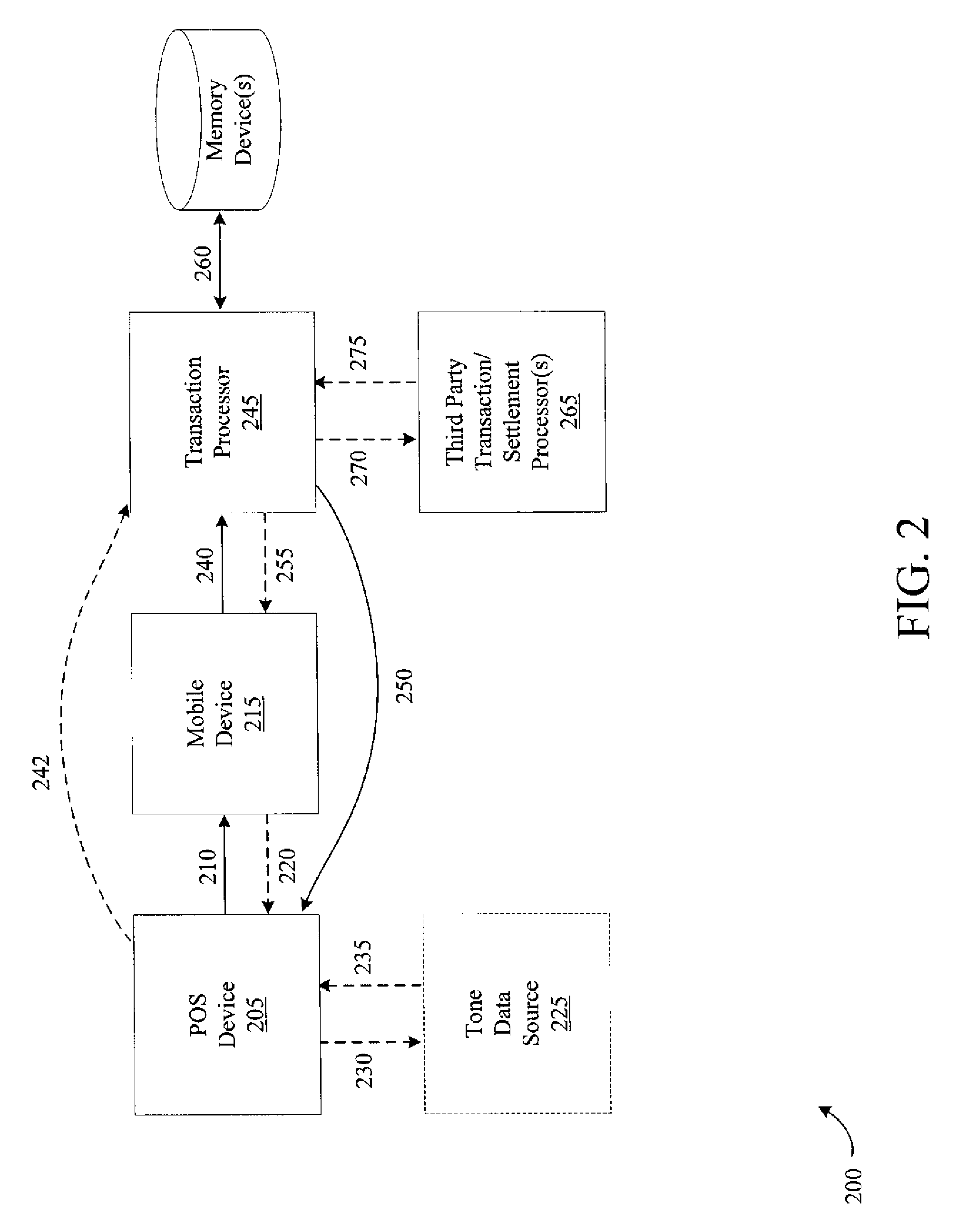

Systems, methods and apparatus for facilitating transactions using a mobile device

ActiveUS20100223145A1Convenient transactionHand manipulated computer devicesFinanceComputer networkEngineering

Systems, methods and apparatus for facilitating transactions using a mobile device are provided by certain embodiments of the invention. Information associated with a proposed transaction may be received at a mobile device from a point of sale device. The mobile device may communicate a request to approve the proposed transaction to a transaction processor. The request may at least a portion of the received information and an identifier associated with the mobile device. The transaction processor may determine whether to approve the proposed transaction and communicate an approval or decline message to the point of sale device.

Owner:FIRST DATA

Method and System for Location Based Hands-Free Payment

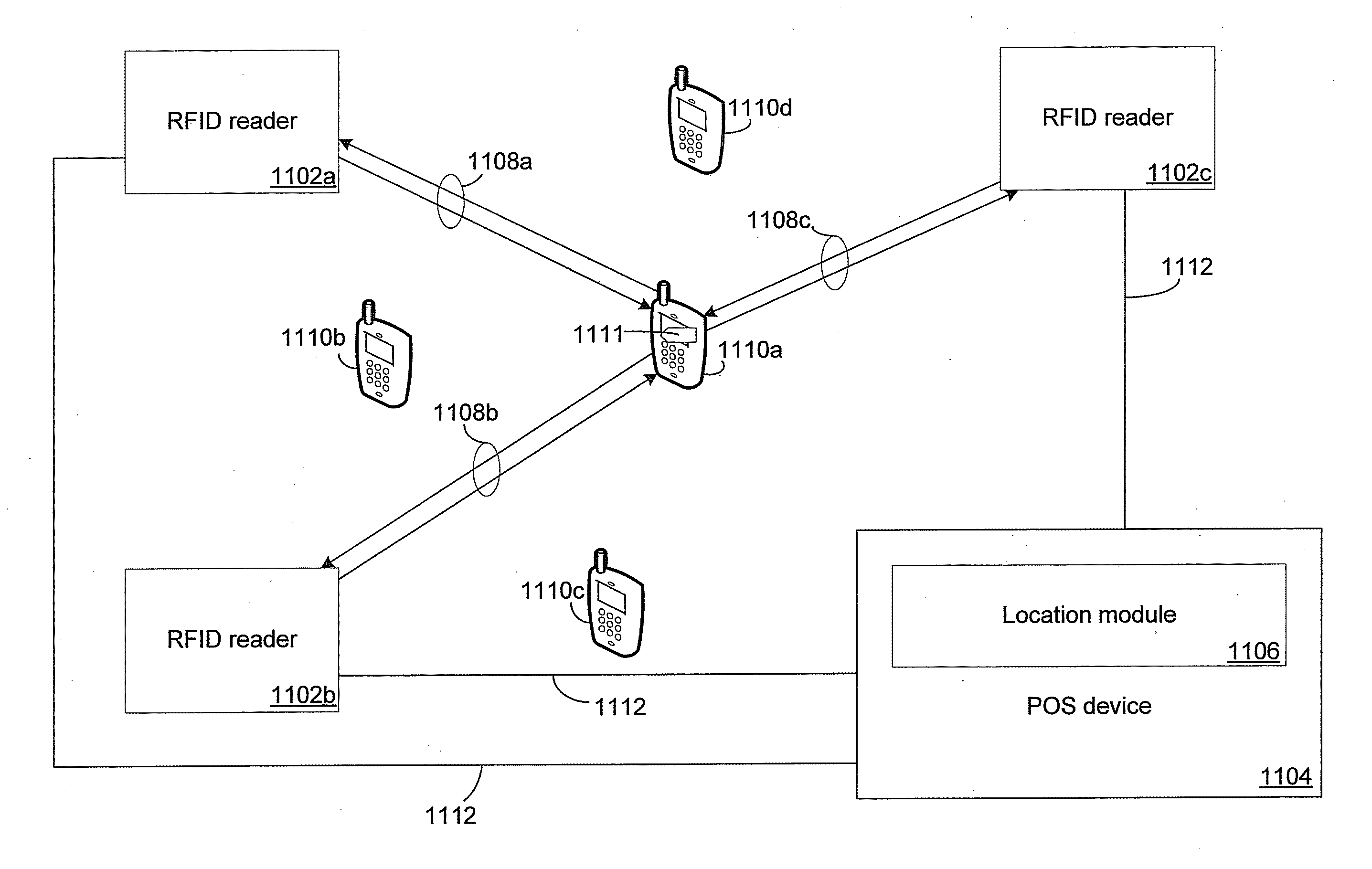

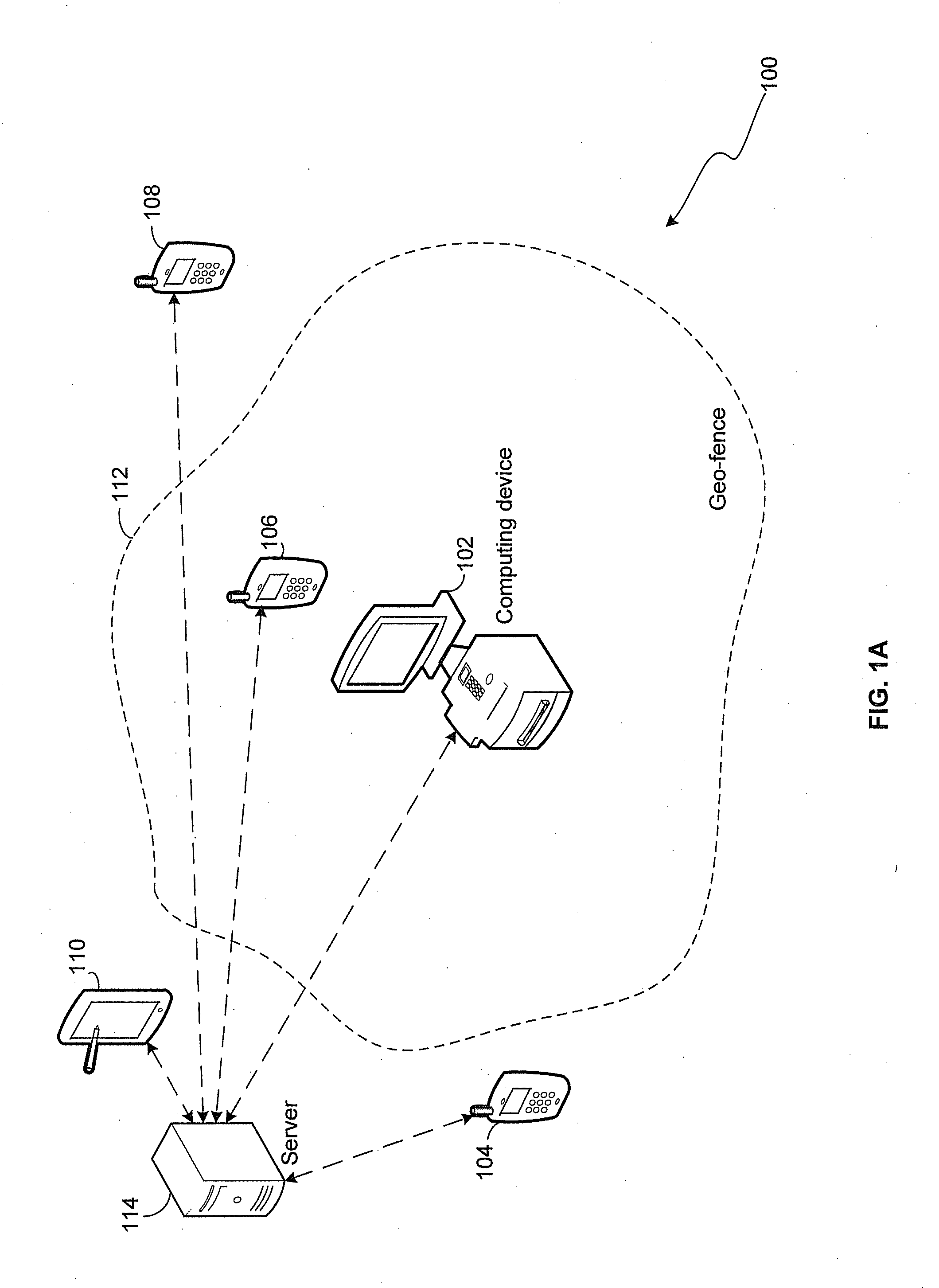

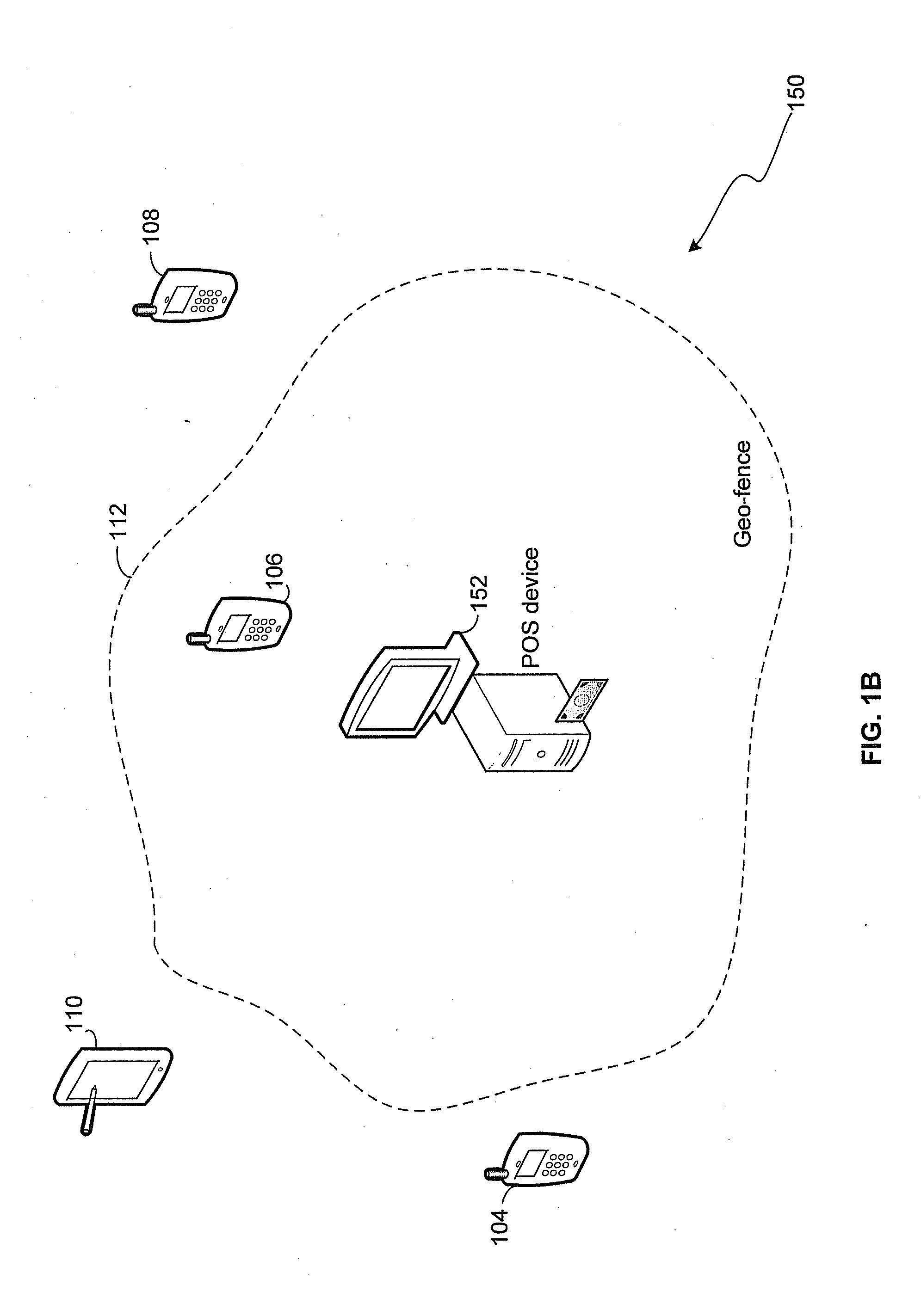

Certain aspects of a method and system for location based hands-free payment may include a network that comprises a plurality of mobile devices and a plurality of point of sale devices. A first mobile device may determine its location coordinates and communicate them to a selected point of sale device. An authorization to execute a payment transaction may be triggered on the first mobile device when it is within a defined proximity of the selected point of sale device. In another embodiment of the invention, a first point of sale device may determine the location coordinates of a selected mobile device and trigger a notification based on a generated geo-fence when the selected mobile device is within a defined proximity of the first point of sale device.

Owner:GOLBA LLC

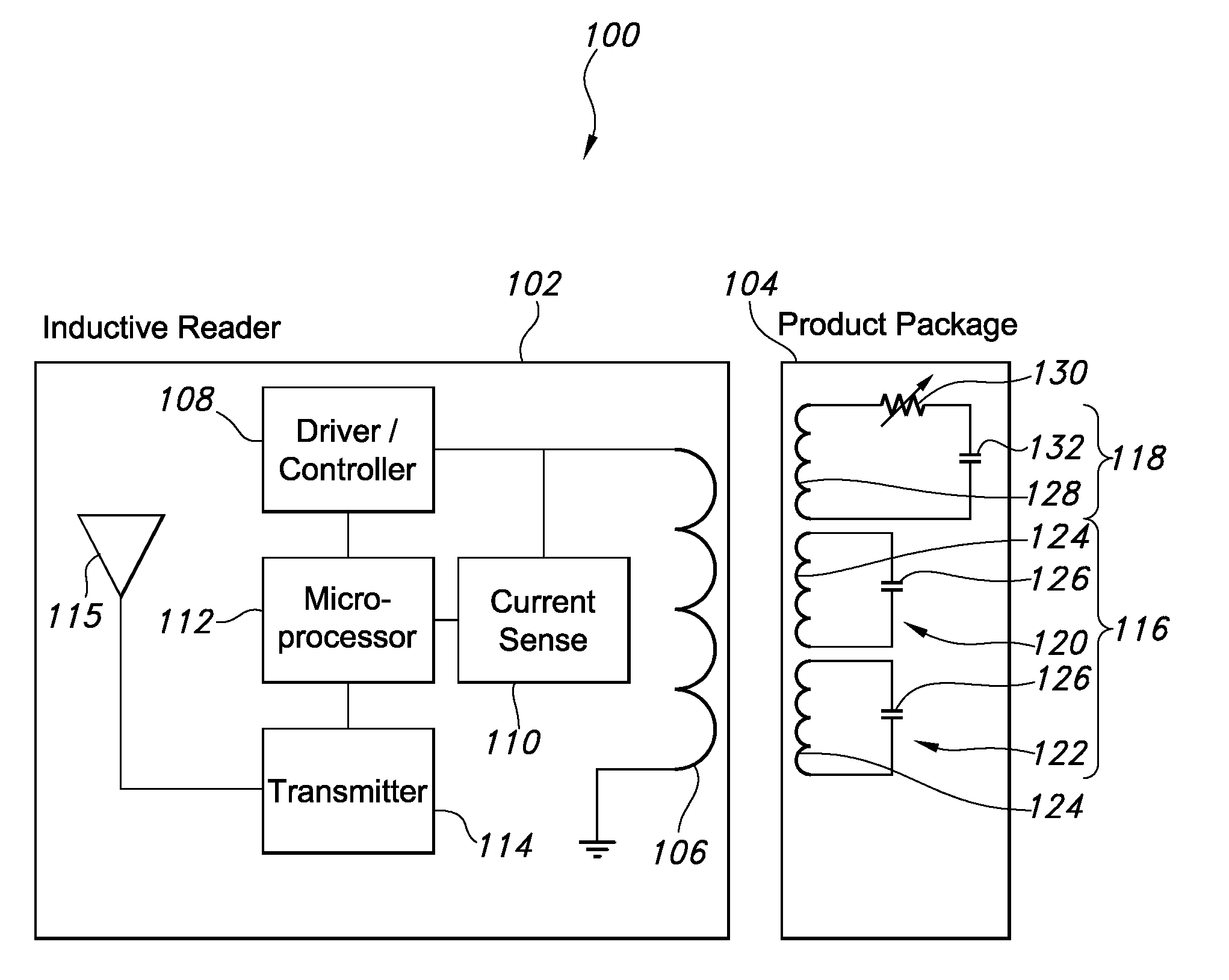

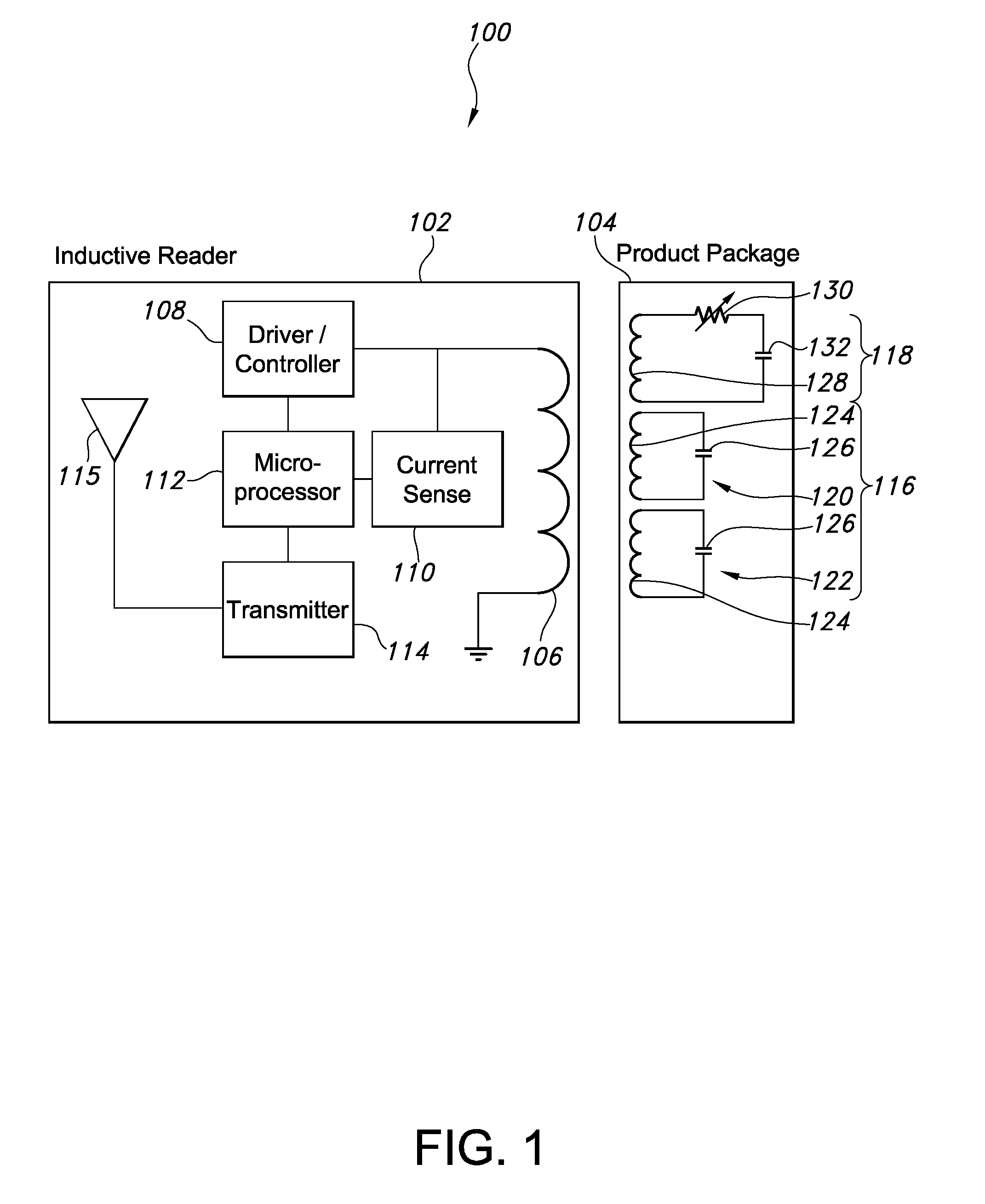

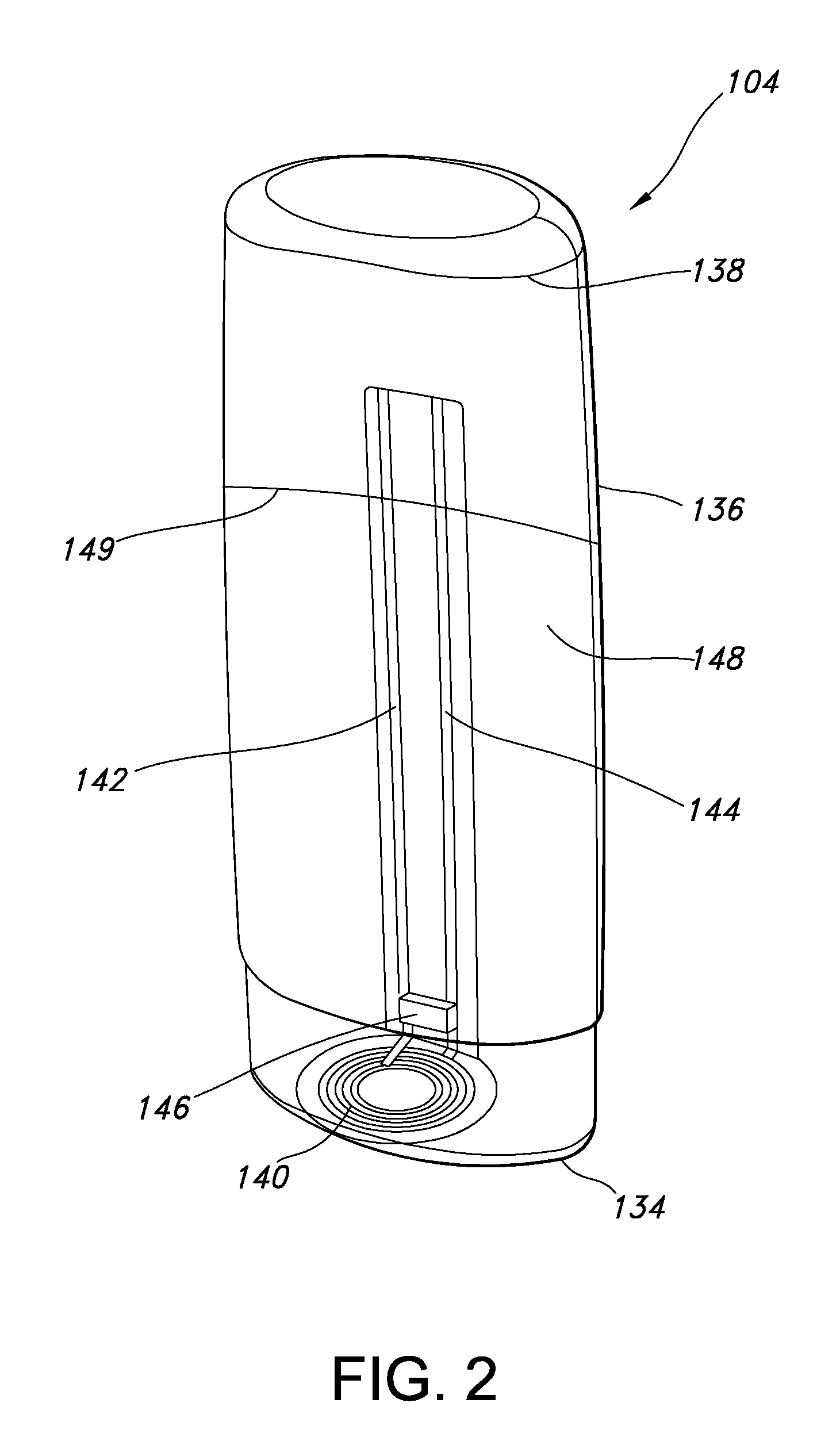

Point of sale inductive systems and methods

Systems and methods for the identification, powering and control of products and product packaging. The systems can include a point of sale display having a contactless power supply. The contactless power supply can provide a source of wireless power for products and product packaging. The products and product packaging can include light emitting diodes, e-ink displays and printed speaker circuits that activate as the operating frequency of the contactless power supply varies. Other embodiments include product level sensors, inductive reader networks, printed temperature sensors, product alignment systems, passive identification circuits and methods for controlling operation of the same.

Owner:BEIJING XIAOMI MOBILE SOFTWARE CO LTD

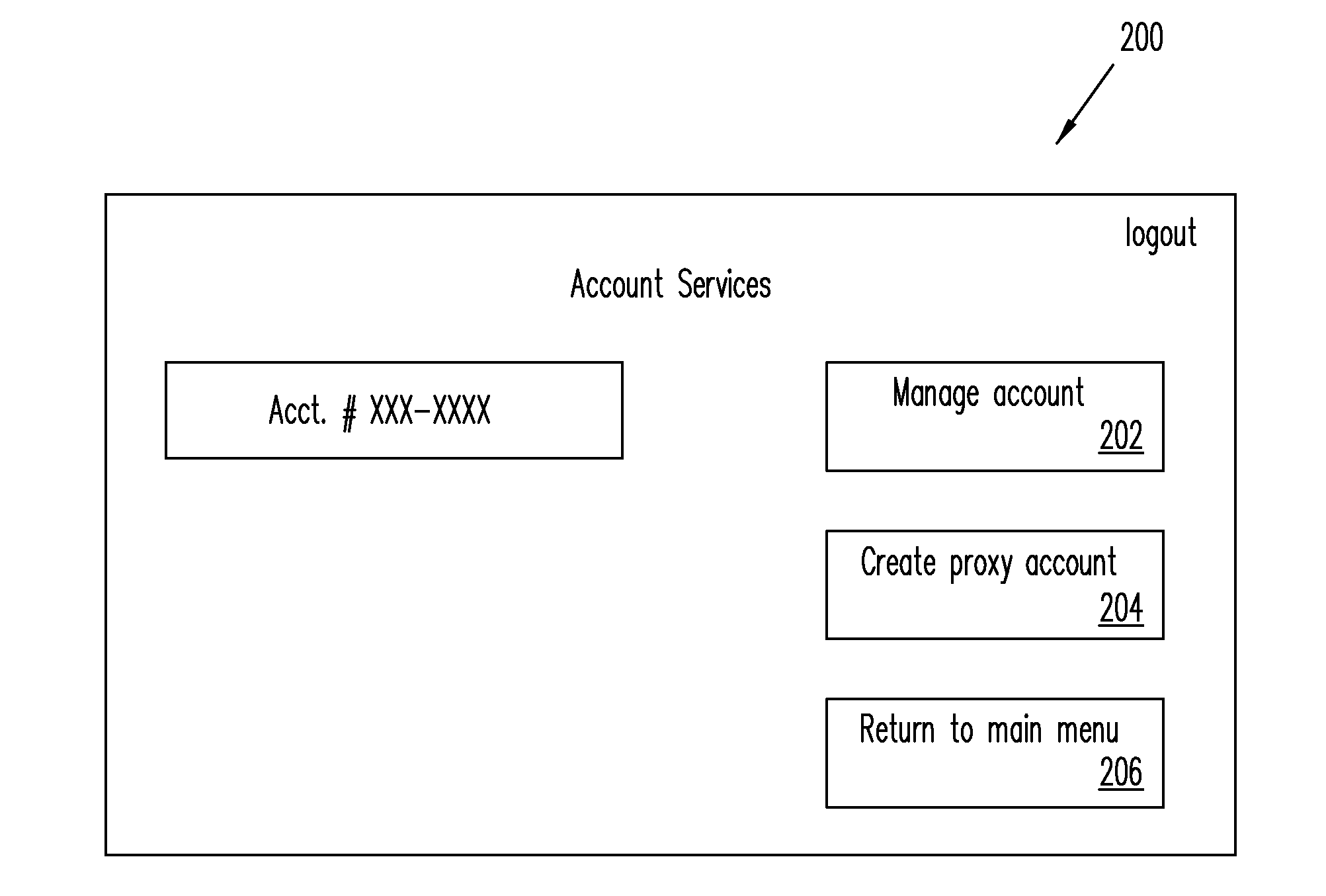

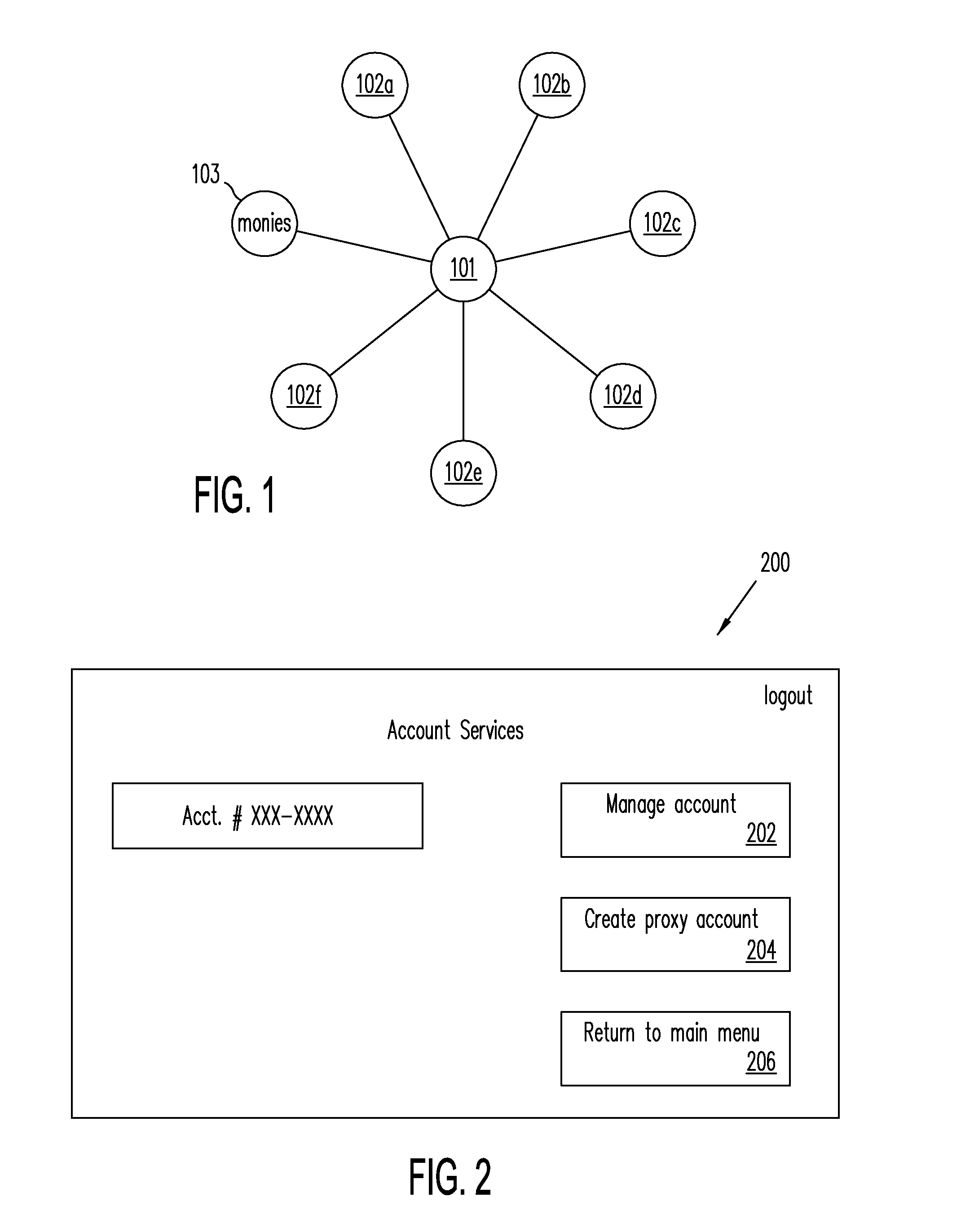

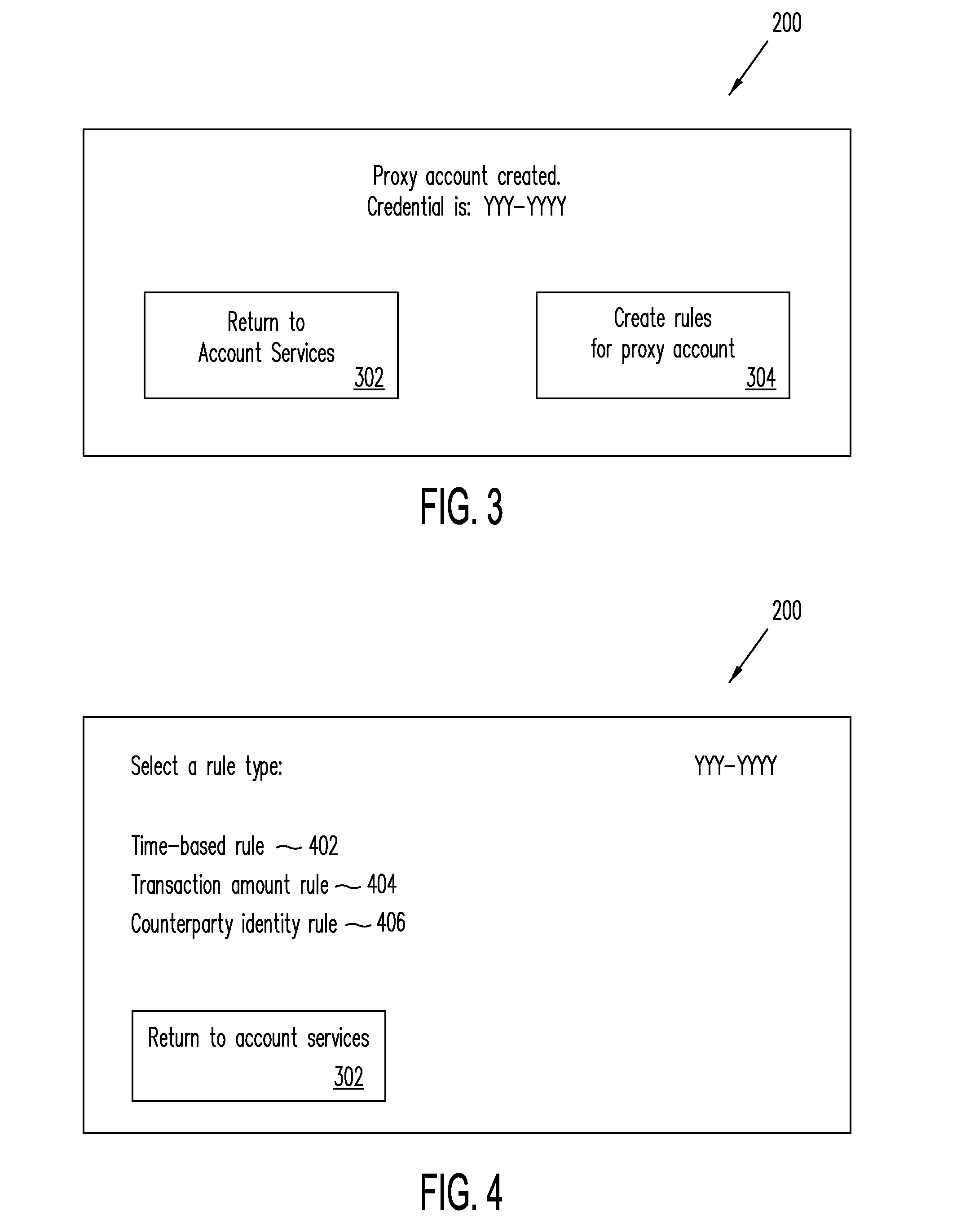

Systems, Methods, and Computer Program Products for Using Proxy Accounts

An electronic device including an input / output interface operable to receive an input from a user and communicate an output to the user, a transceiver operable to electronically communicate with a computer network, a computer processor operable to execute instructions, and a memory storage operable to store the instructions, the memory storage further comprising a program module that is operable to: receive credentials for a proxy payment account, where the proxy payment account is linked to a primary payment account and not linked directly to a method of payment underlying the primary payment account, and make payment at a Point of Sale (POS) using the received credentials.

Owner:PAYPAL INC

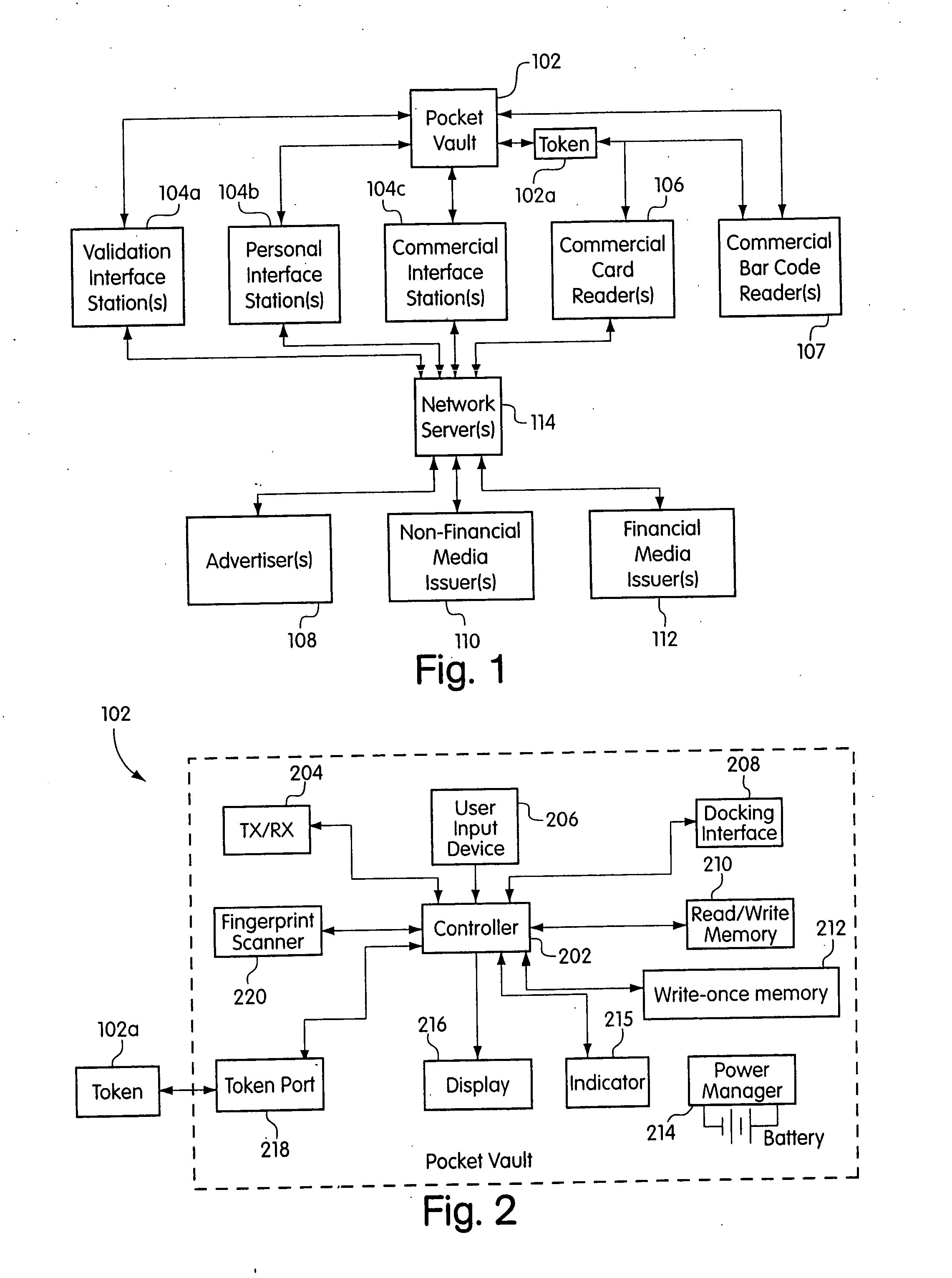

Portable electronic authorization system and method

Owner:KIOBA PROCESSING LLC

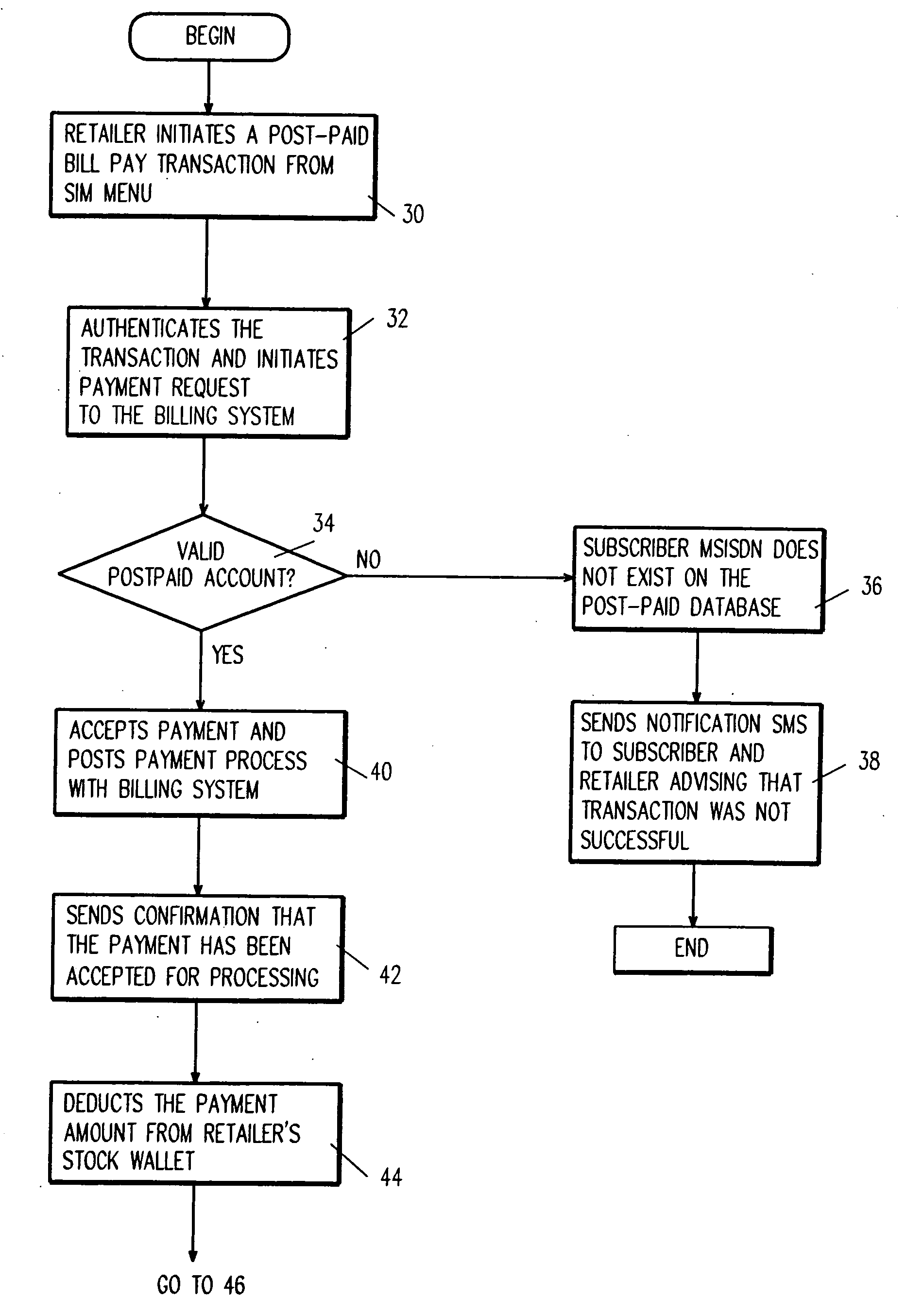

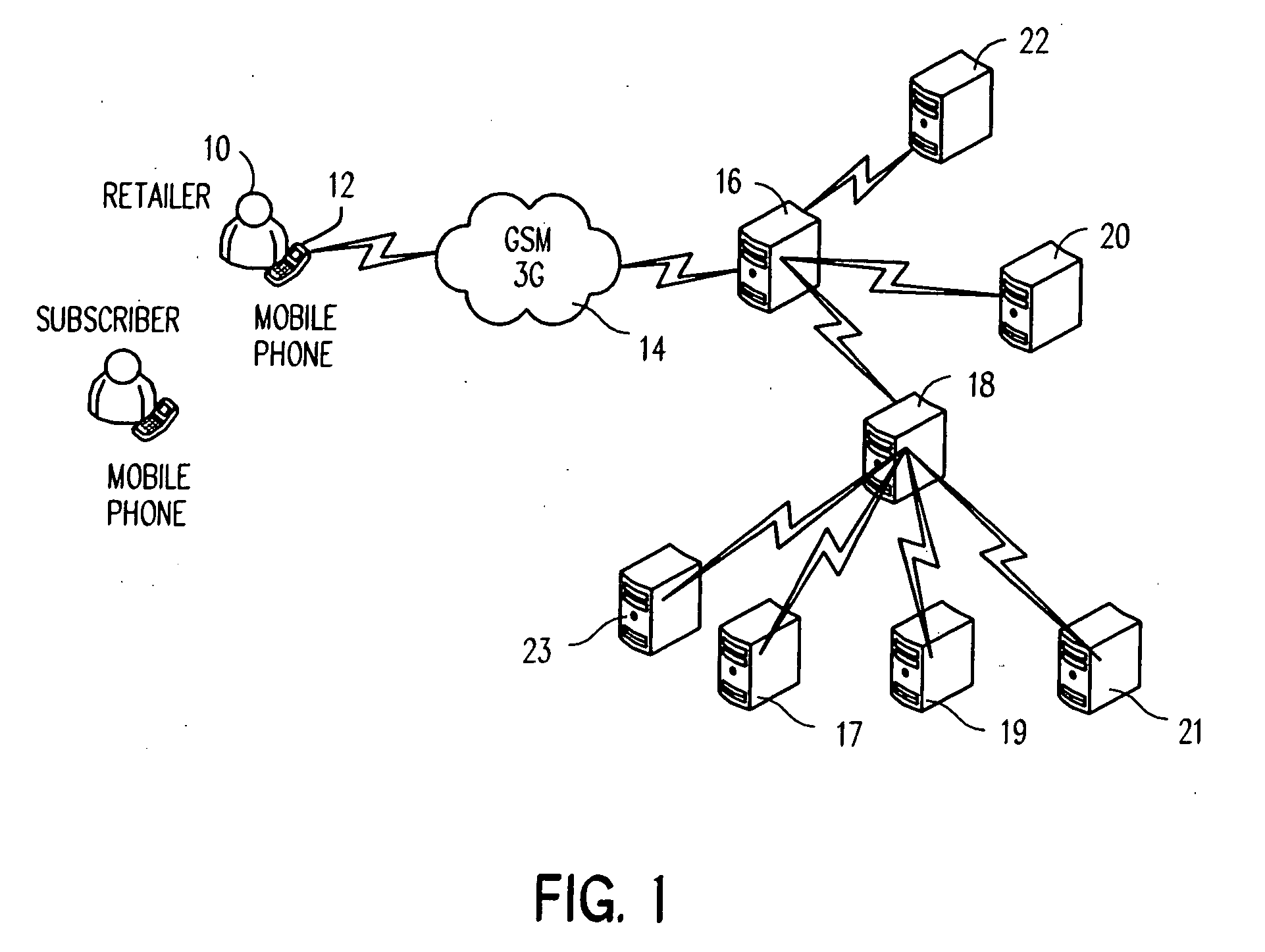

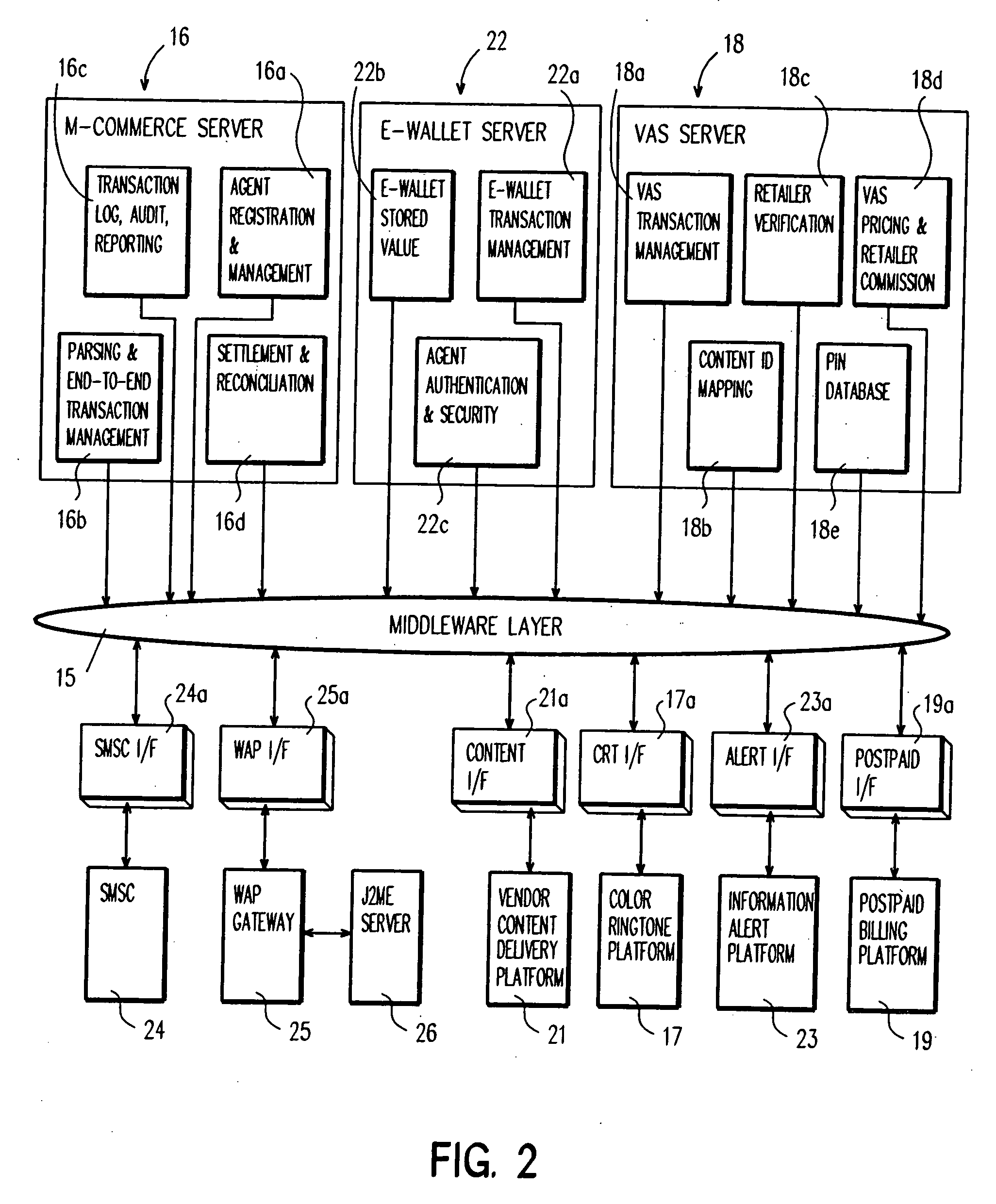

Mobile phone as a point of sale (POS) device

InactiveUS20070106564A1Easy accessAcutation objectsAccounting/billing servicesMobile deviceComputer science

A system and method for provisioning one or more value added services to a postpaid / prepaid mobile account and / or a postpaid / prepaid mobile device using a wireless communication device as a point-of-sale device, is disclosed.

Owner:SHANGHAI RES INST OF PETROCHEMICAL TECH SINOPEC +1

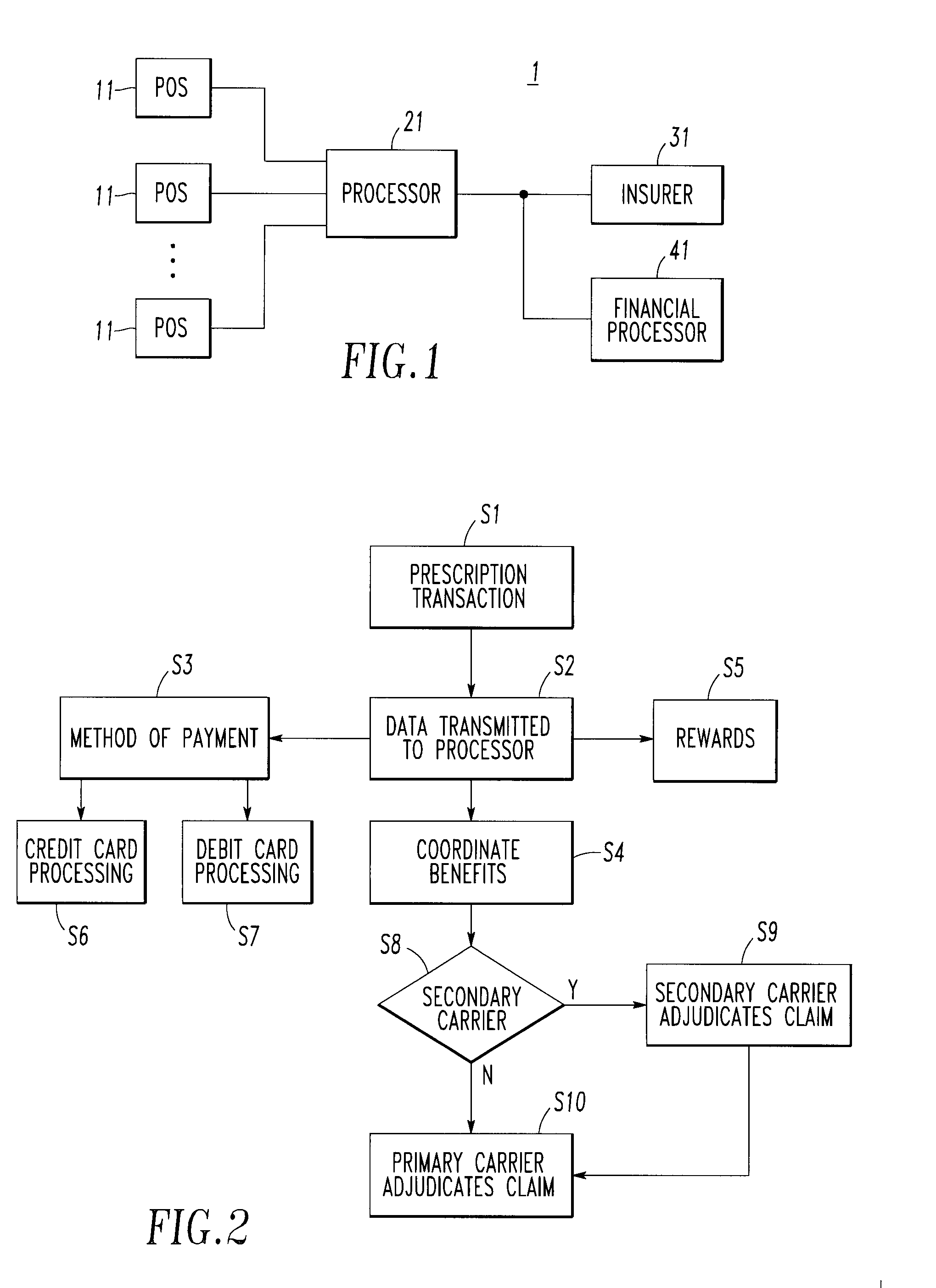

Integrated pharmaceutical accounts management system and method

InactiveUS20020002495A1Facilitate real-time adjudicationEasy to processHand manipulated computer devicesDrug and medicationsData warehouseDrug interaction

<heading lvl="0">Abstract of Disclosure< / heading> An integrated suite of services for consumers, service providers and manufacturers in the pharmaceutical industry is disclosed. The present invention utilizes one or more of the NCPDP standard formats and adopts the switch for an integrated system of, for example, instant adjudication of prescriptions, consumer data warehousing and / or incentive rewards for the consumer. A participating consumer with one card, can instantly purchase pharmaceuticals and charge the transaction to a credit card and earn and apply savings dollars redeemable for pharmaceutical purchases. For a participating service provider, instant adjudication and instant validation of consumer eligibility can be performed. Moreover, a service provider may receive messages related to the patient's medications. Significantly, data is recorded for consumers even when consumers make the pharmaceutical purchase with cash. The system includes a unique card issued to participating consumers. The card is adapted to encode conventional credit or debit card information specific to the participating consumer so that the consumer can consummate a transaction for the purchase of pharmaceuticals without possession of an additional credit card. The system further includes a host processor coupled to the point of sale at the service provider through a leased line or public switch network or the like. When a customer performs a pharmaceutical transaction at the point of sale of the service provider, the host processor coordinates any benefits and data with other prescription benefit management systems through messages transmitted and received from any primary or secondary carrier systems. The host processor further is adapted to facilitate real-time adjudication of claims and checks for any dangerous drug-to-drug interactions. The host processor additionally facilitates any financial processing including the accumulation and redemption of any bonus dollars earned by the consumer. Furthermore, since the card used by the consumer can be encoded with credit or debit card information, the host processor determines the desired payment method and performs the actual financial transaction. Even if the transaction at the point of sale is a cash purchase, the consumer may desire to use his unique card for the accrual of bonus dollars. Therefore, data concerning the transaction (i.e., pharmacy number, prescription number, etc.) can be recorded even for transactions conducted with cash.

Owner:NPAX

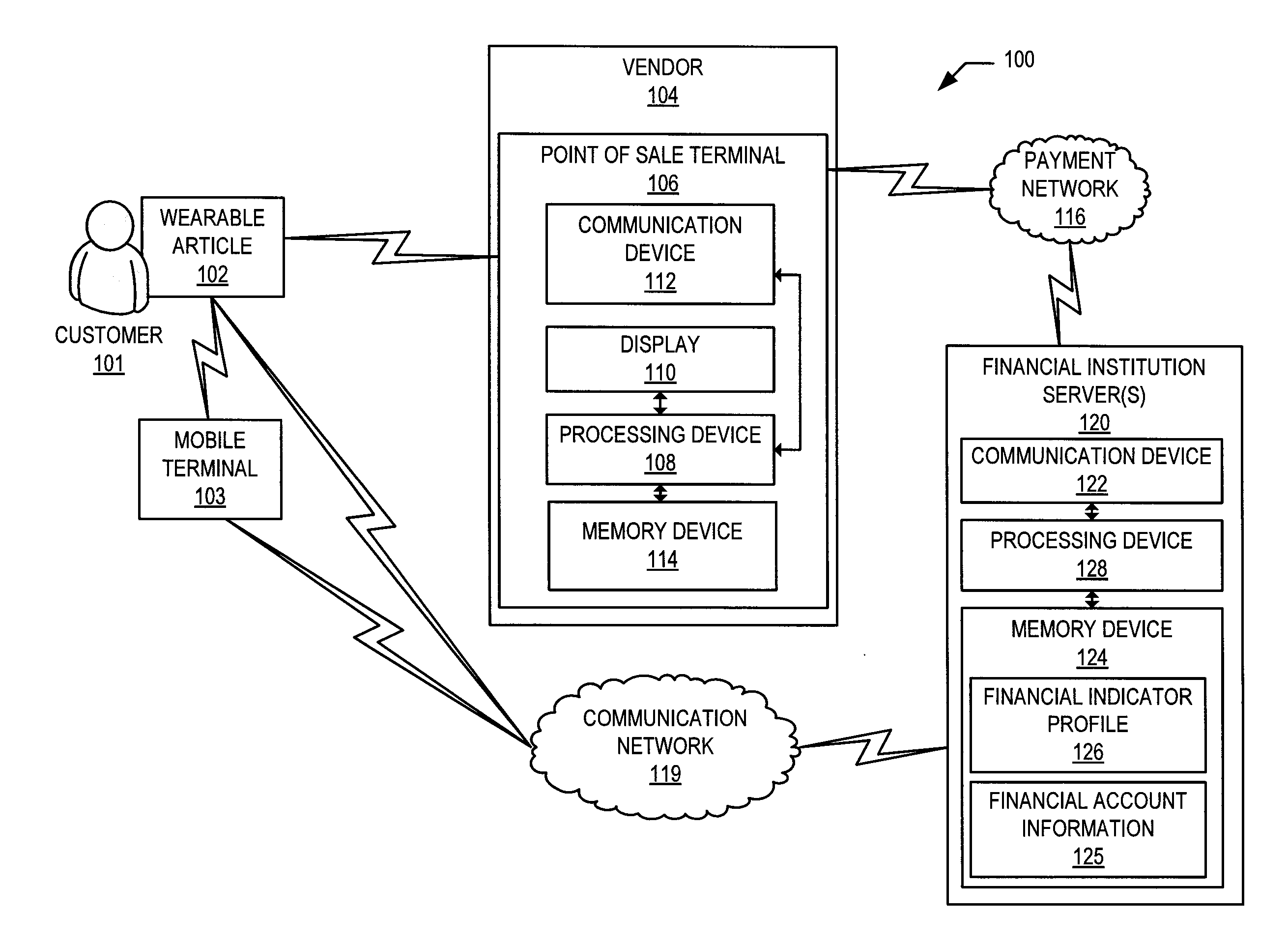

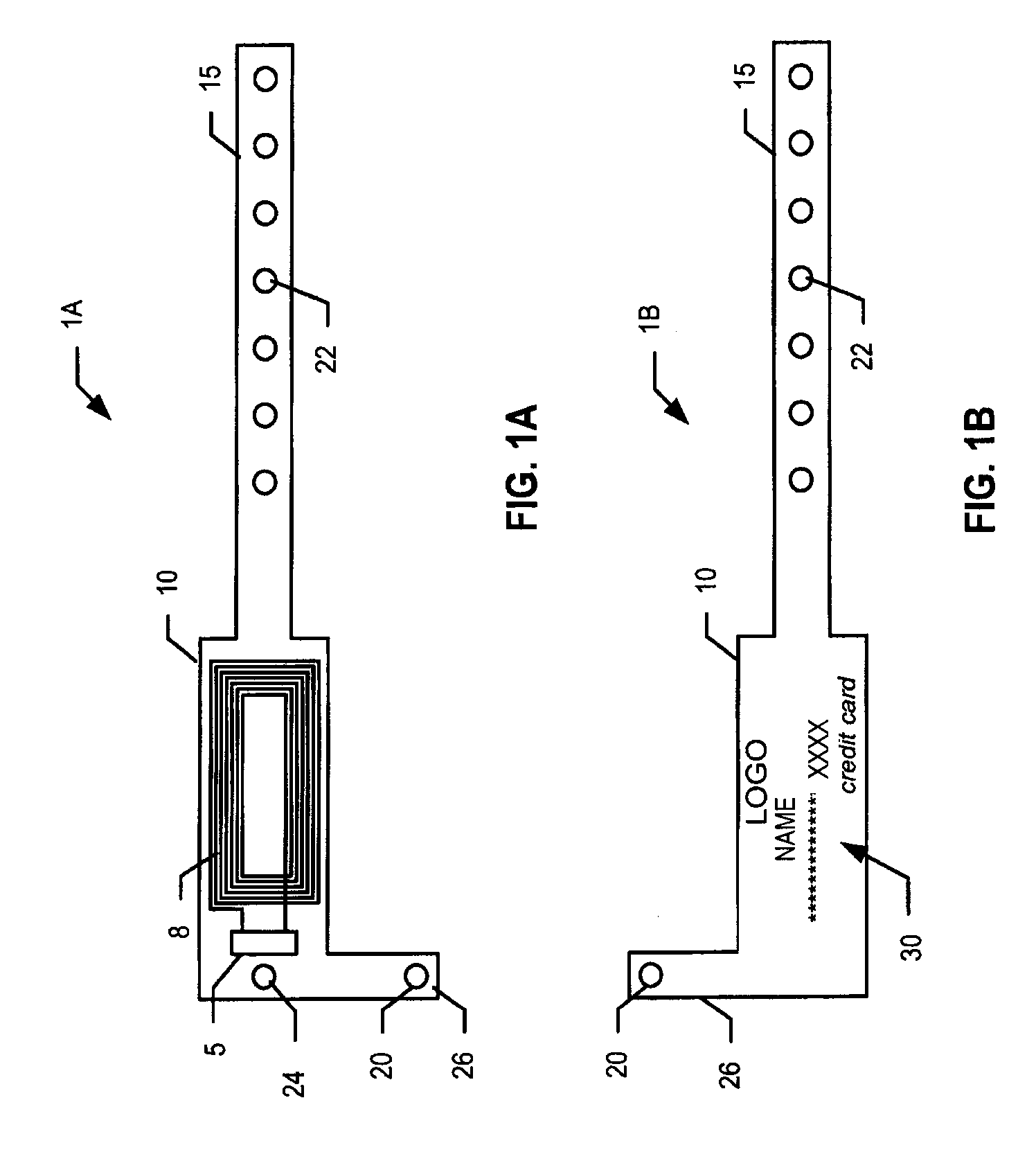

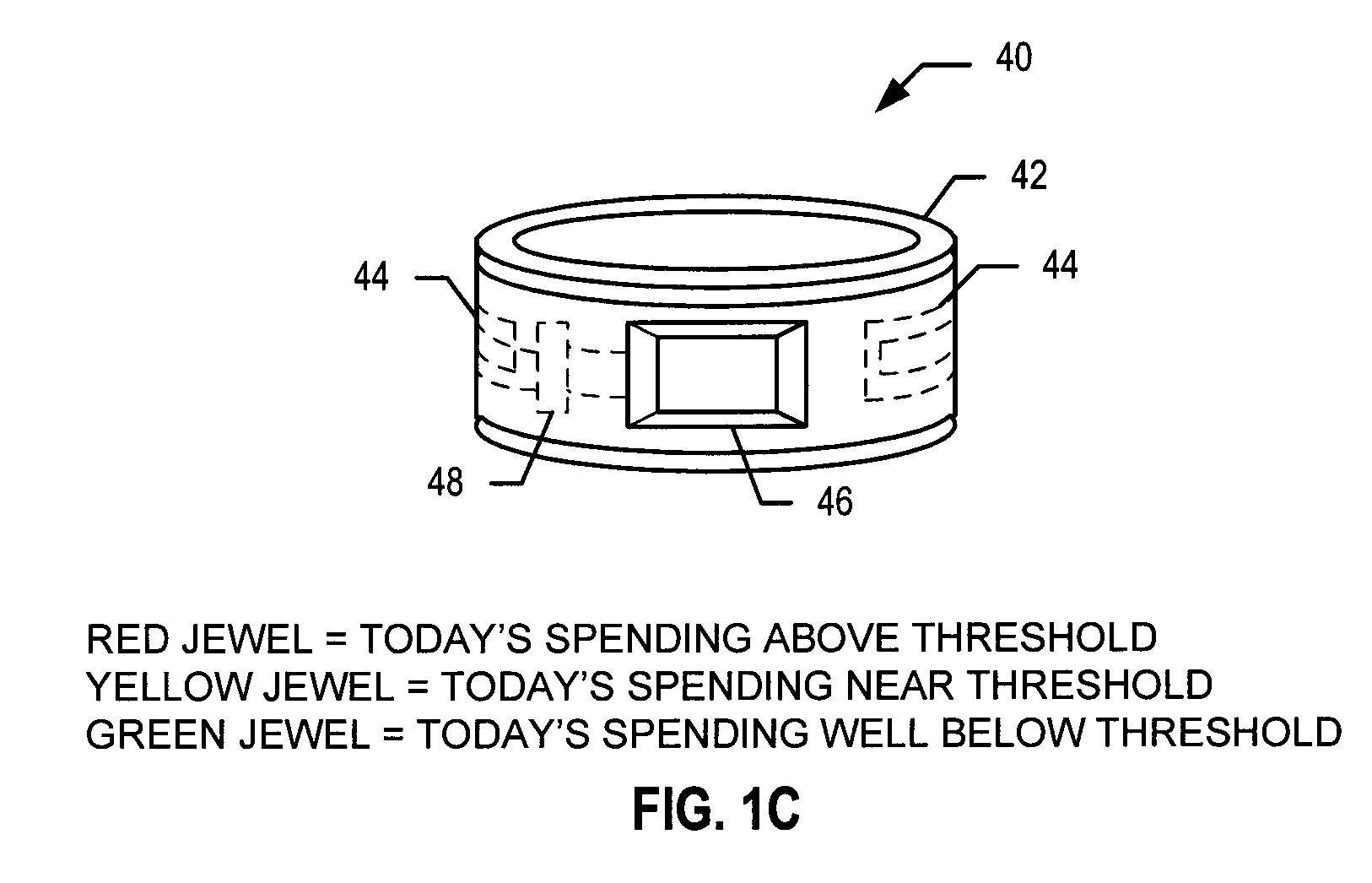

Wearable article having point of sale payment functionality

A wearable article is configured for providing payment information to a point of sale terminal during a transaction. The wearable article, in some embodiments, includes a band configured for wrapping around a body part of the customer and for carrying an electronic device. In some embodiments, the band has an attachment system for removably securing the band to the body part of the customer. The electronic device includes an energy storage element, a memory device, a communication device and a processing device. The processing device is configured for receiving a communication from the point of sale terminal requesting payment information for completion of the transaction. The processing device reads account information from the memory device and communicates payment information to the point of sale terminal. In some embodiments, the wearable article receives power from a field generated by the point of sale terminal.

Owner:BANK OF AMERICA CORP

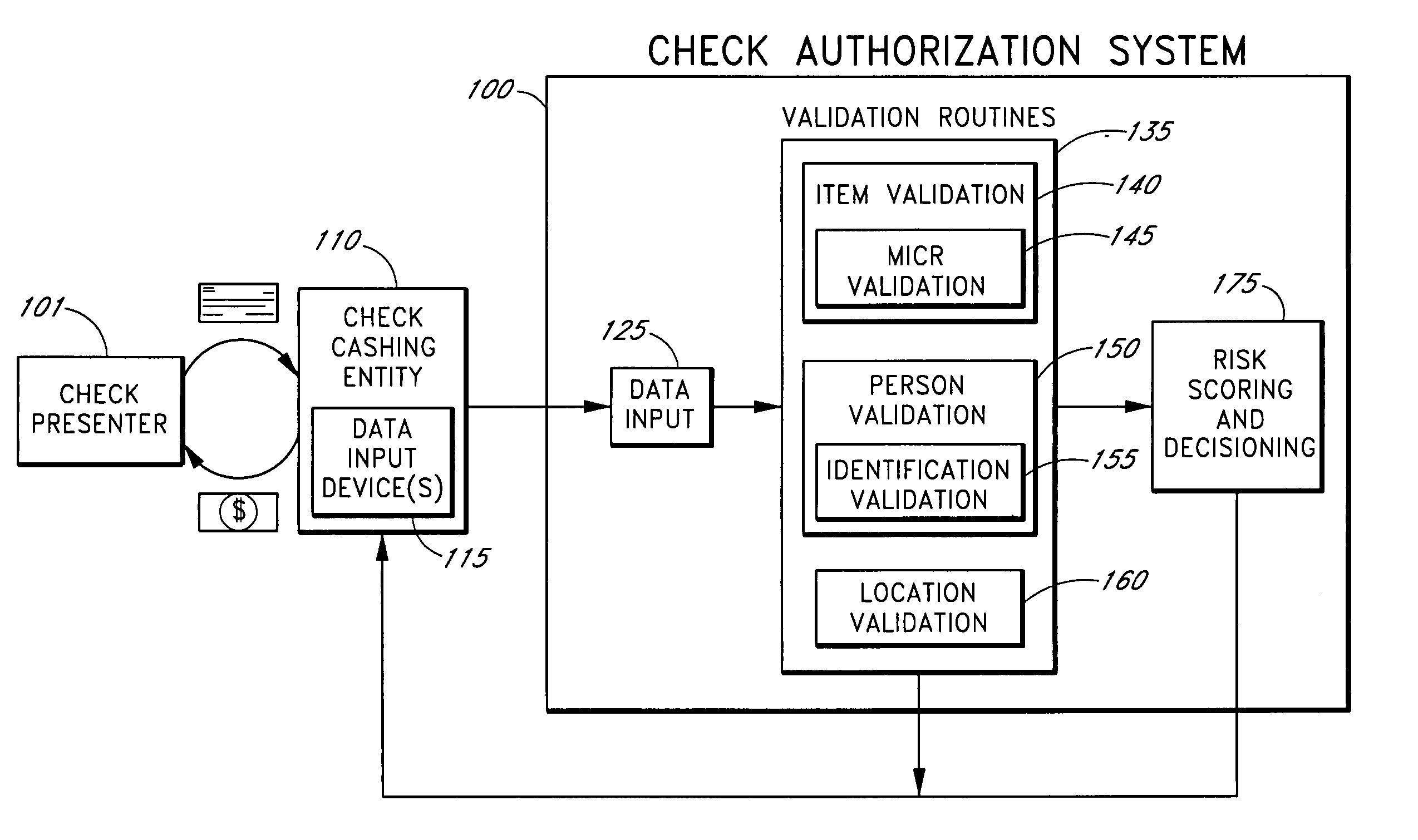

Systems and methods for obtaining authentication marks at a point of sale

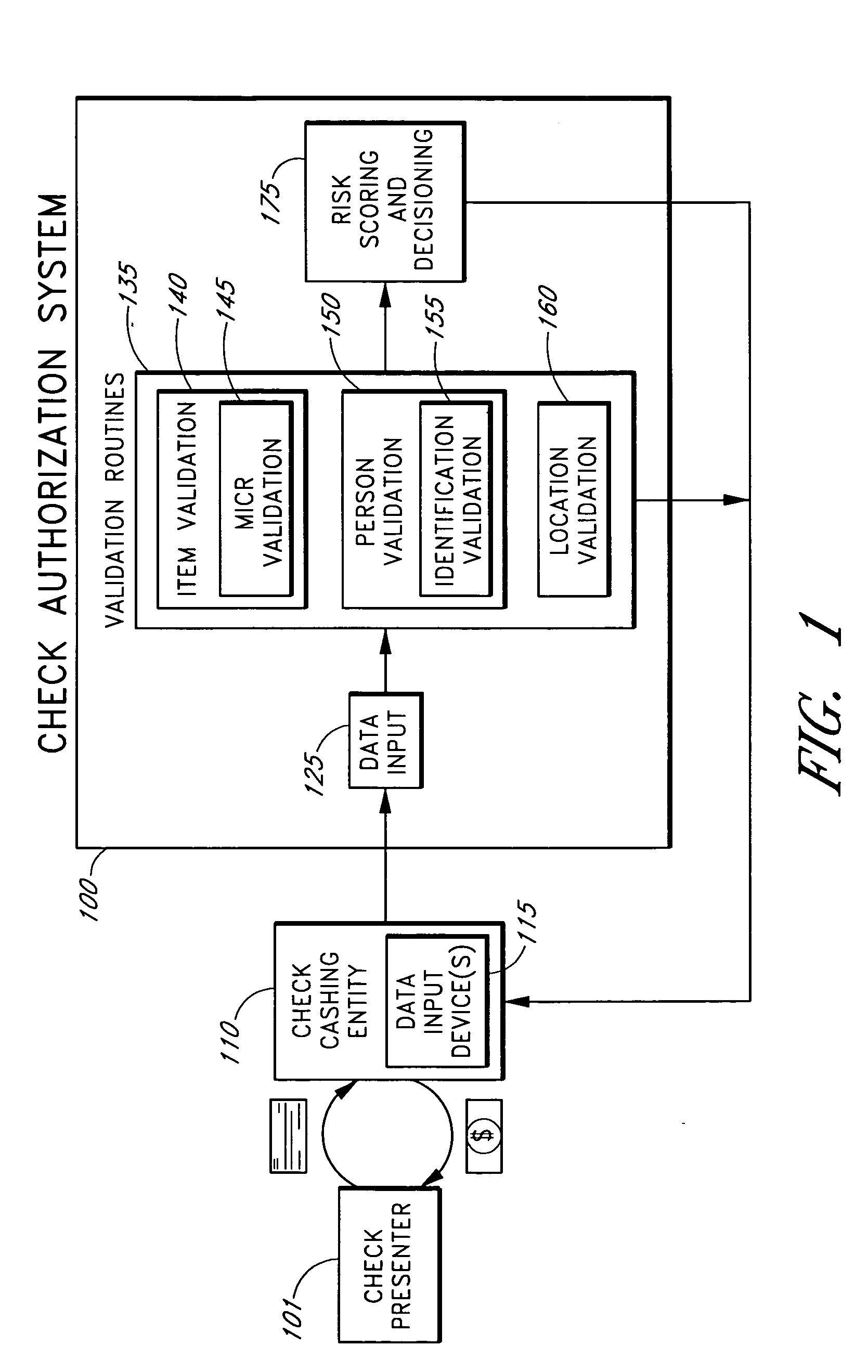

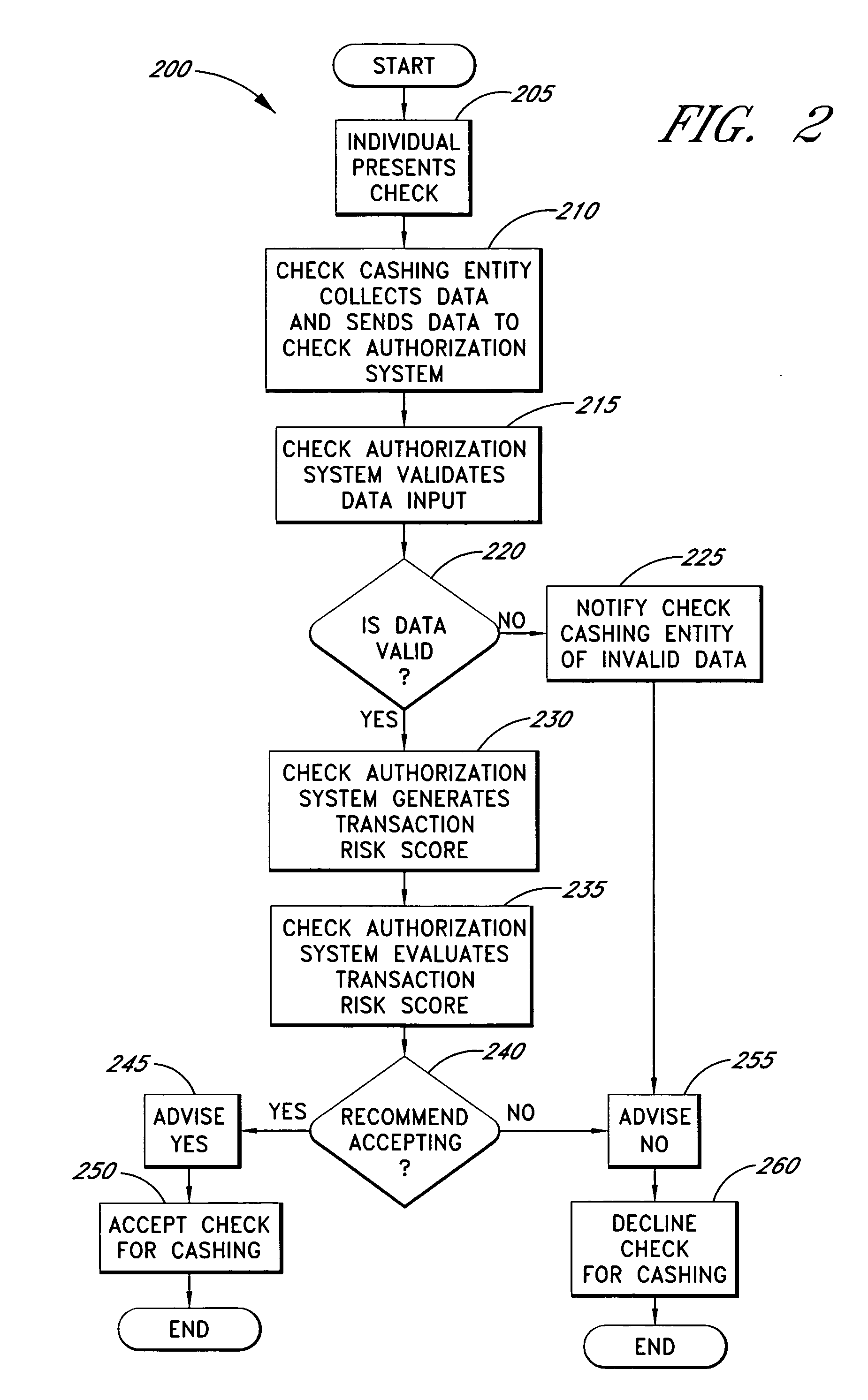

InactiveUS20050125360A1Accurate descriptionSlow processPaper-money testing devicesPoint-of-sale network systemsBarcodeCheque

Systems and methods are described for using a point-of-sale device at a check-cashing entity to obtain information about one or more authenticating marks, such as watermarks, bar codes, background patterns, color schemes, insignia, security validation numbers, or the like, from a second-party check or other negotiable instrument presented for a proposed check-cashing transaction. In various embodiments, the authenticating mark information may be compared to stored information about expected configurations of authenticating marks as part of a risk assessment of the check. In various embodiments, the point-of-sale device transmits authenticating mark information to a check authorization system. The point-of-sale device may receive an accept / decline recommendation for the transaction from the check authorization system, based at least in part on the obtained authenticating mark information. The point-of-sale device may display a message about the recommendation to an operator of the device.

Owner:FIRST DATA

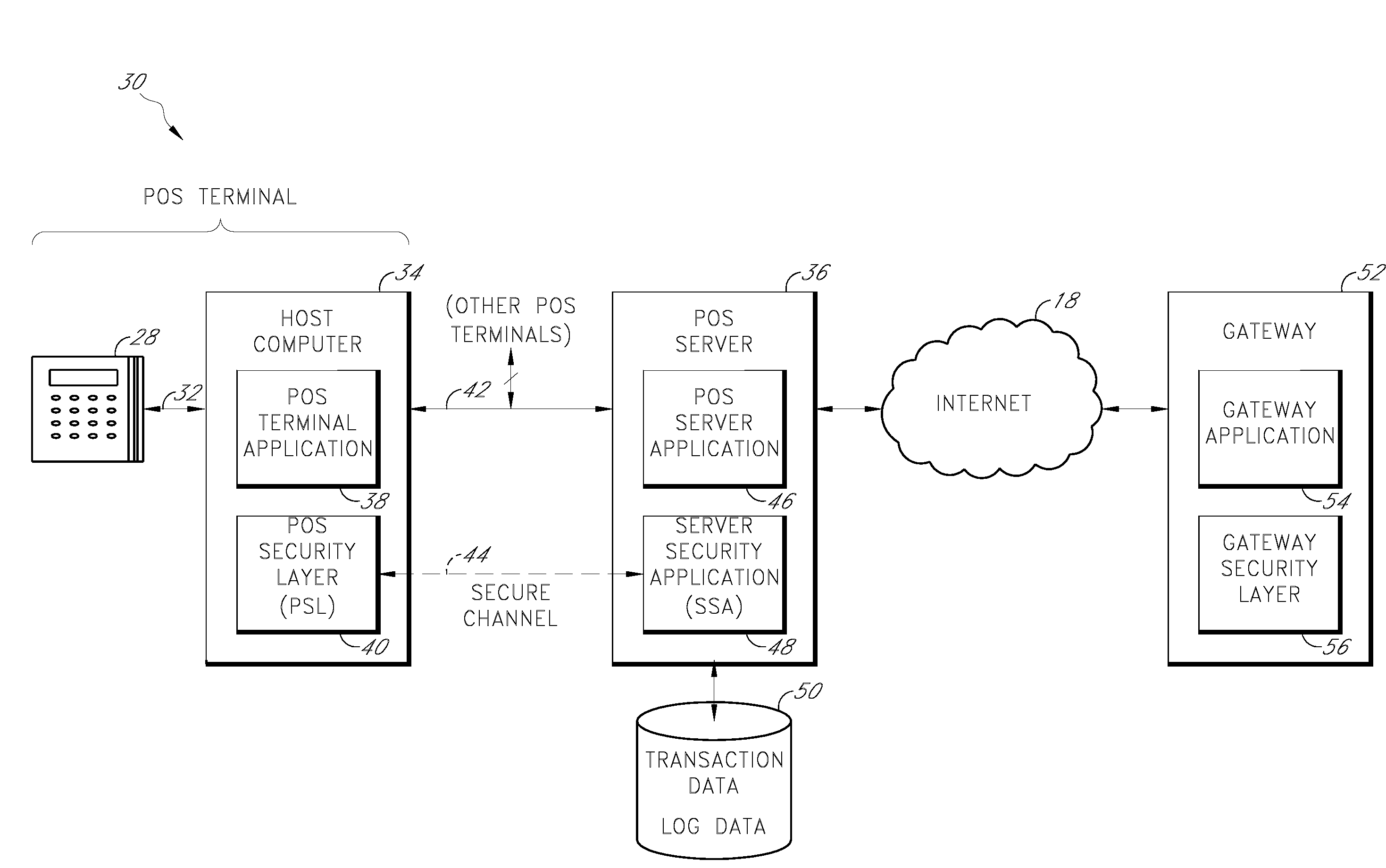

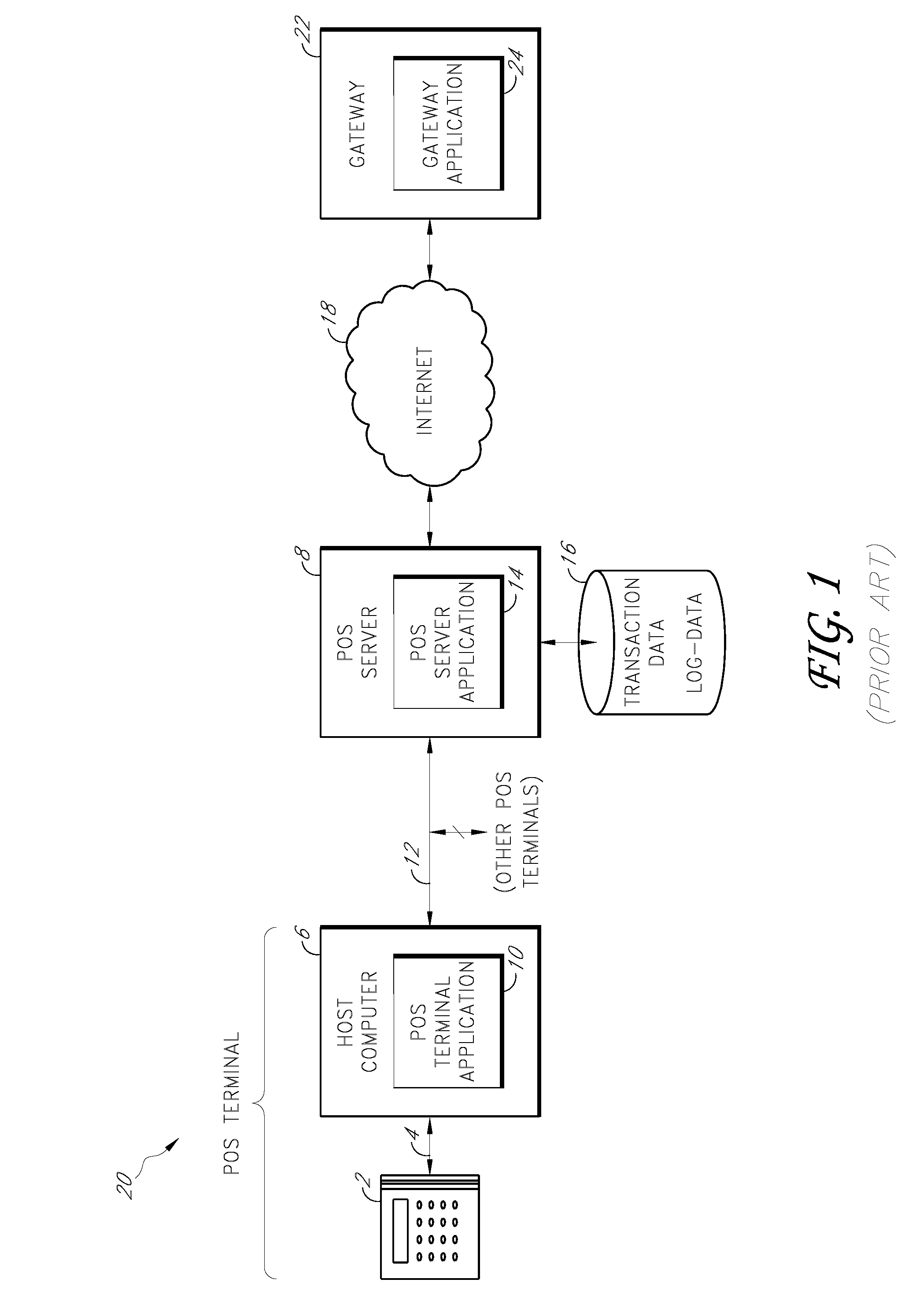

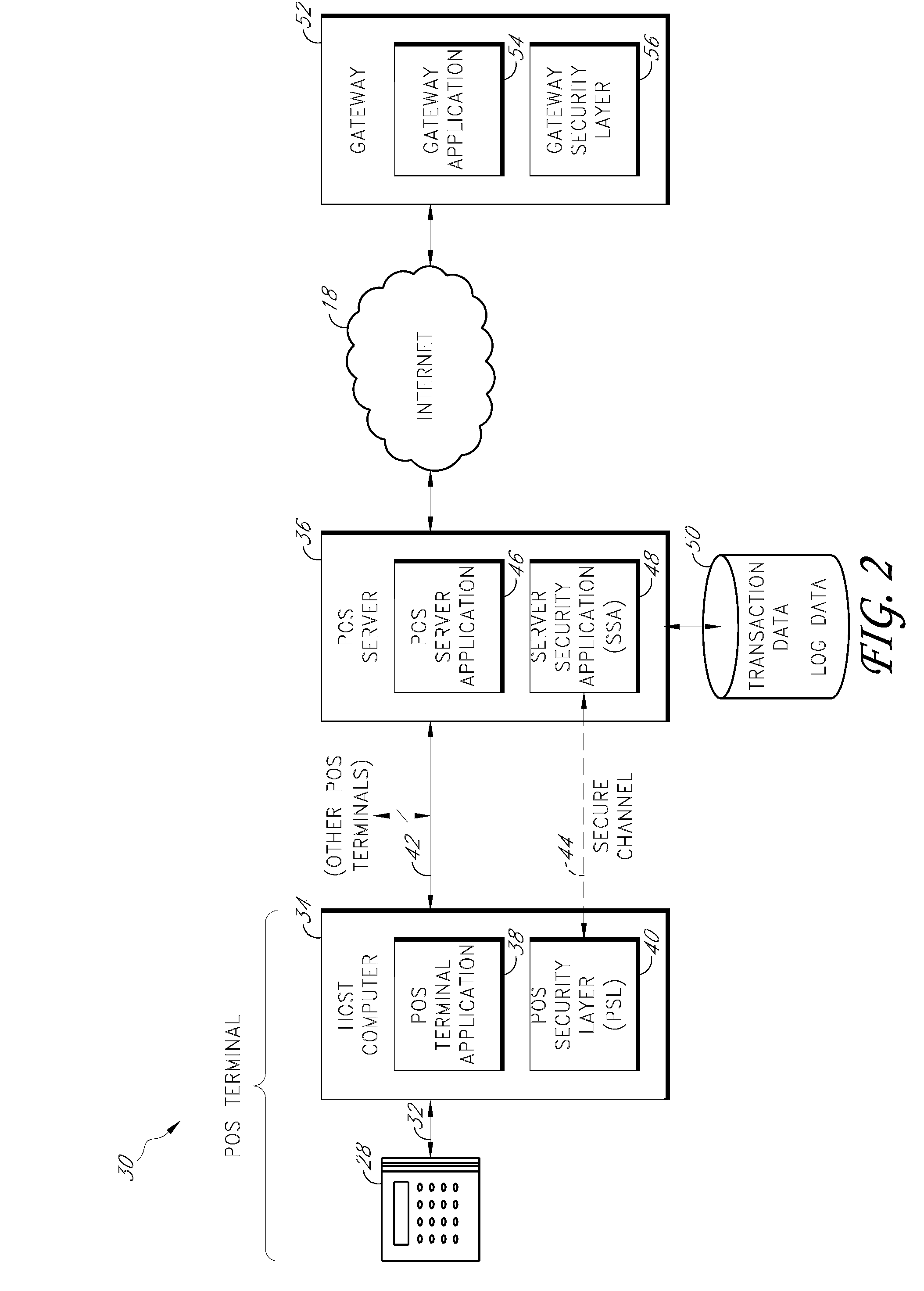

Secure payment card transactions

Payment card transactions at a point of sale (POS) are secured in certain embodiments by intercepting, with a POS security layer installed on a POS terminal, payment data from the POS terminal, transmitting the payment data from the POS security layer to a server security application installed on a POS server, and providing false payment data from the POS security layer to a POS terminal application installed on the POS terminal. The false payment data in various embodiments is processed as if it were the payment data, such that the POS terminal transmits an authorization request to the POS server using the false payment data. In addition, the authorization request may be transmitted from the POS server to a payment gateway.

Owner:SHIFT4 CORP

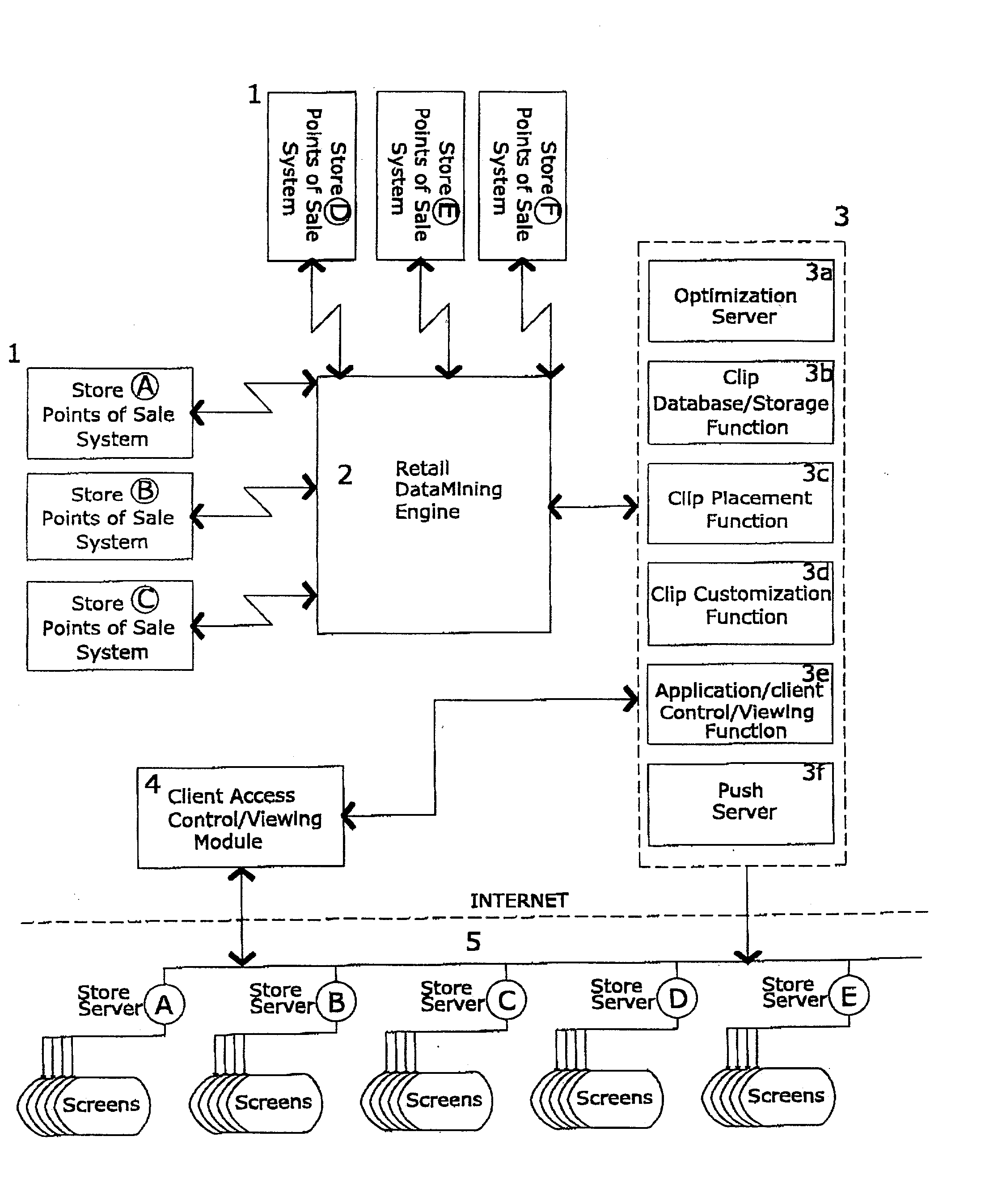

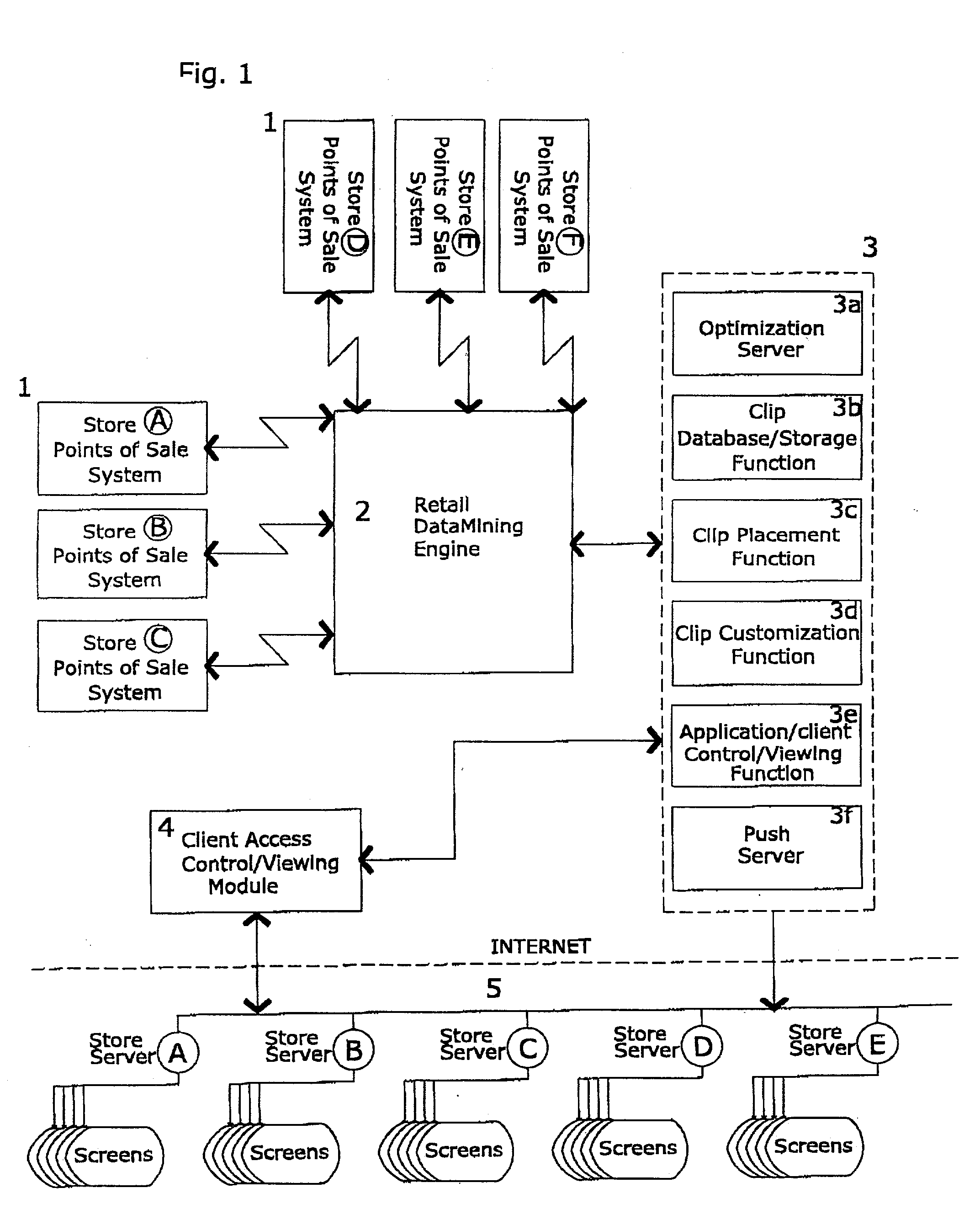

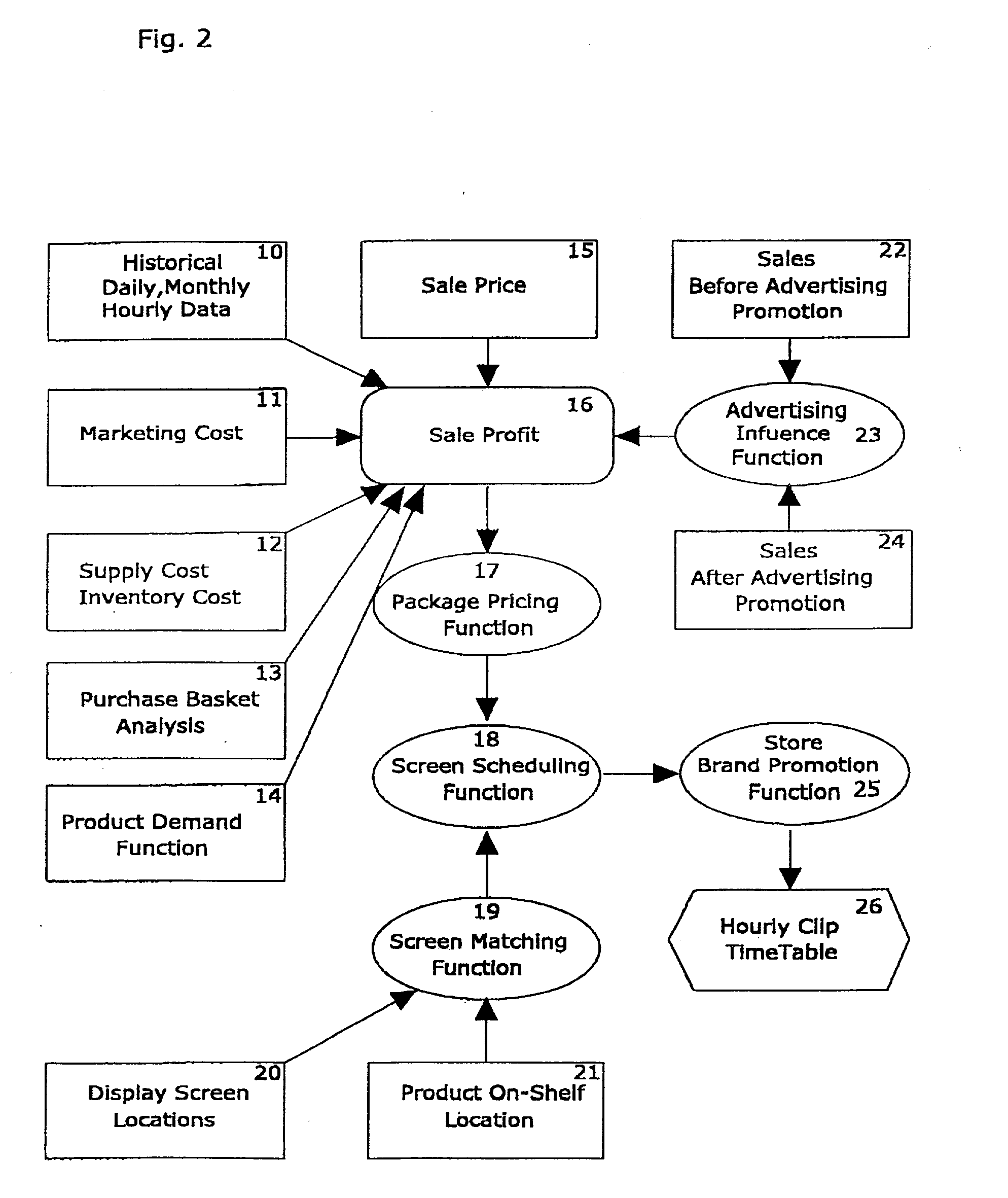

Method and system for maximizing sales profits by automatic display promotion optimization

The present invention is remotely controlled automatic optimization system for maximizing in-store net profits by customized script-generated clip promotions to thousands of individually networked retail display-nodes from central server (OptiRetailChain). The computer-based and machine-learning display system includes: an advertising optimization function for display nodes, point of sale (POS) data input, retail database mining engine (RDME), client access and management control module, and in-store networked electronic clip display apparatus. The optimization function obtains data from chain-store database, combines product bundling data, which describe the associative relationships of various product sales in stores with recorded times of sale, inventory costs, margin profits etc. Physical location of purchased products on the store floor-areas are correlated with relevant display-nodes to create optimal clip display program (playlist) configurations for that specific display location and time. Most preferred product advertising combinations will be displayed in the best time slots for each node automatically. OptiRetailChain uses two methods of promotion optimization: real time scheduling and longer-term statistical optimization. Utilizing the machine learning capabilities, actual video-clip playlists will be dynamically updated for every display-node and respond to daily sales fluctuations for that store display location. This enables the optimization system to effectively control and automatically feature target advertising to large number of display-nodes in supermarket chain networks optimizing advertising capital without necessitating outside intervention.

Owner:MAKOR ISSUES & RIGHTS

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com