Patents

Literature

1622results about "Pre-payment schemes" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

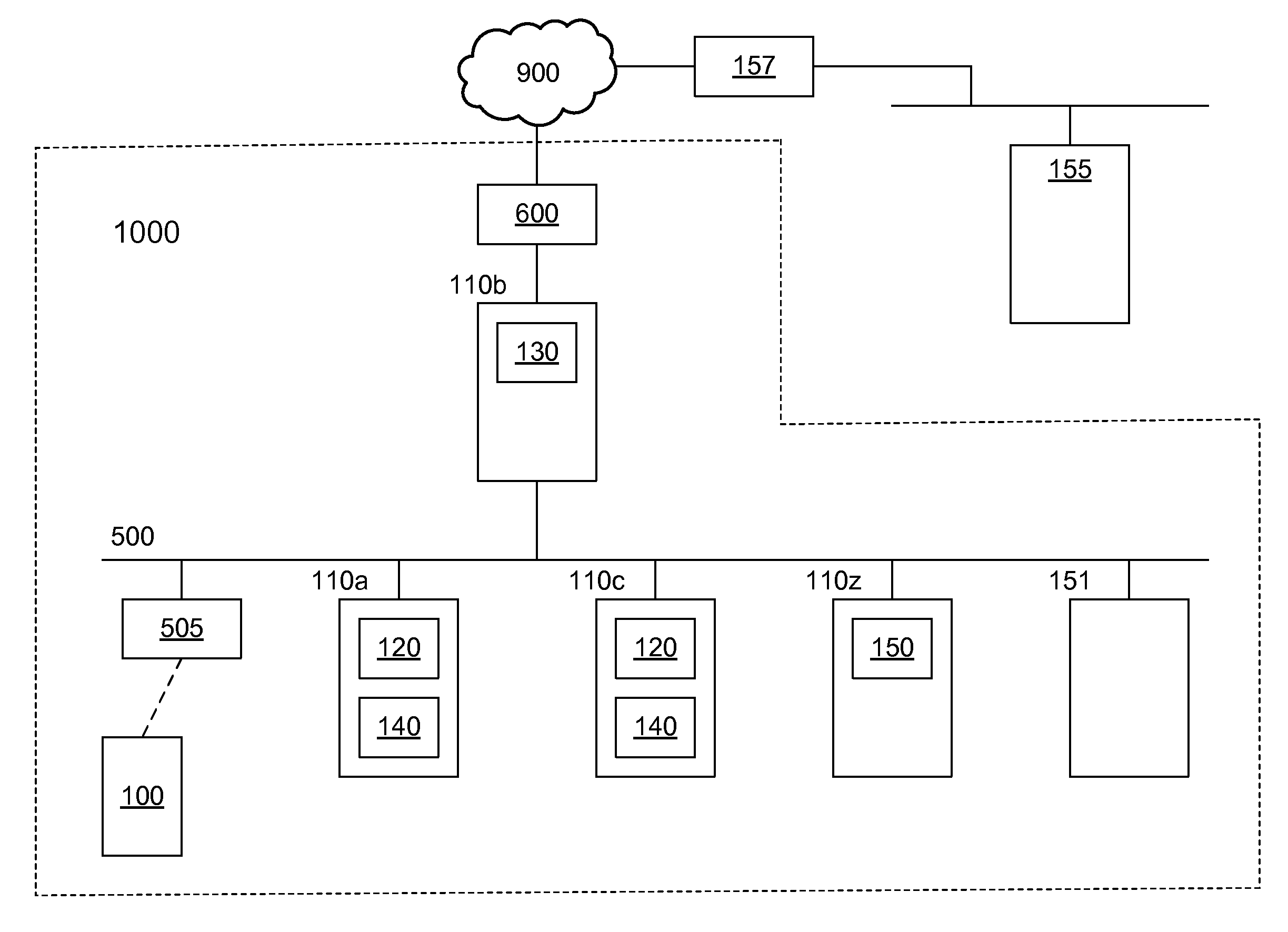

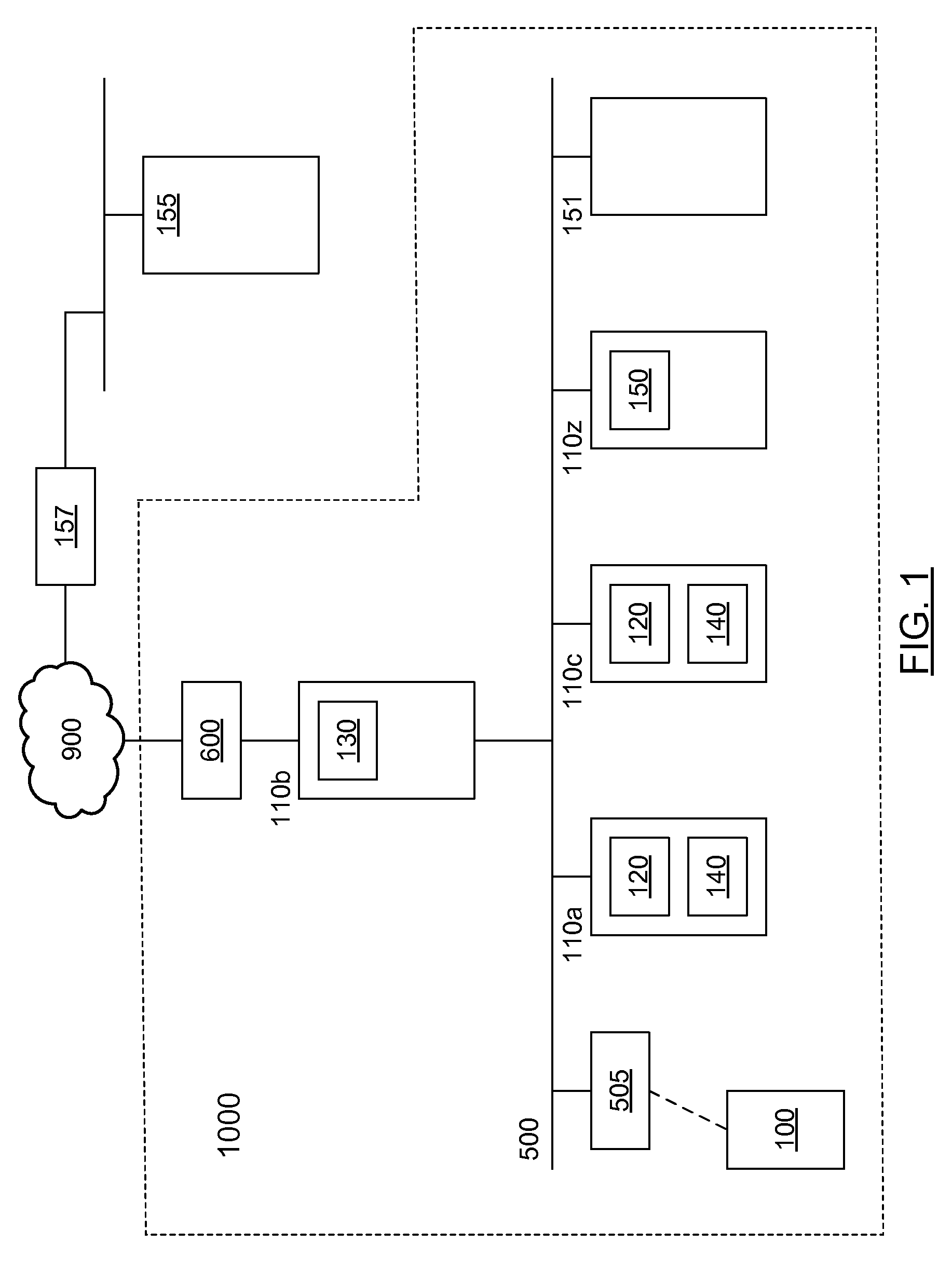

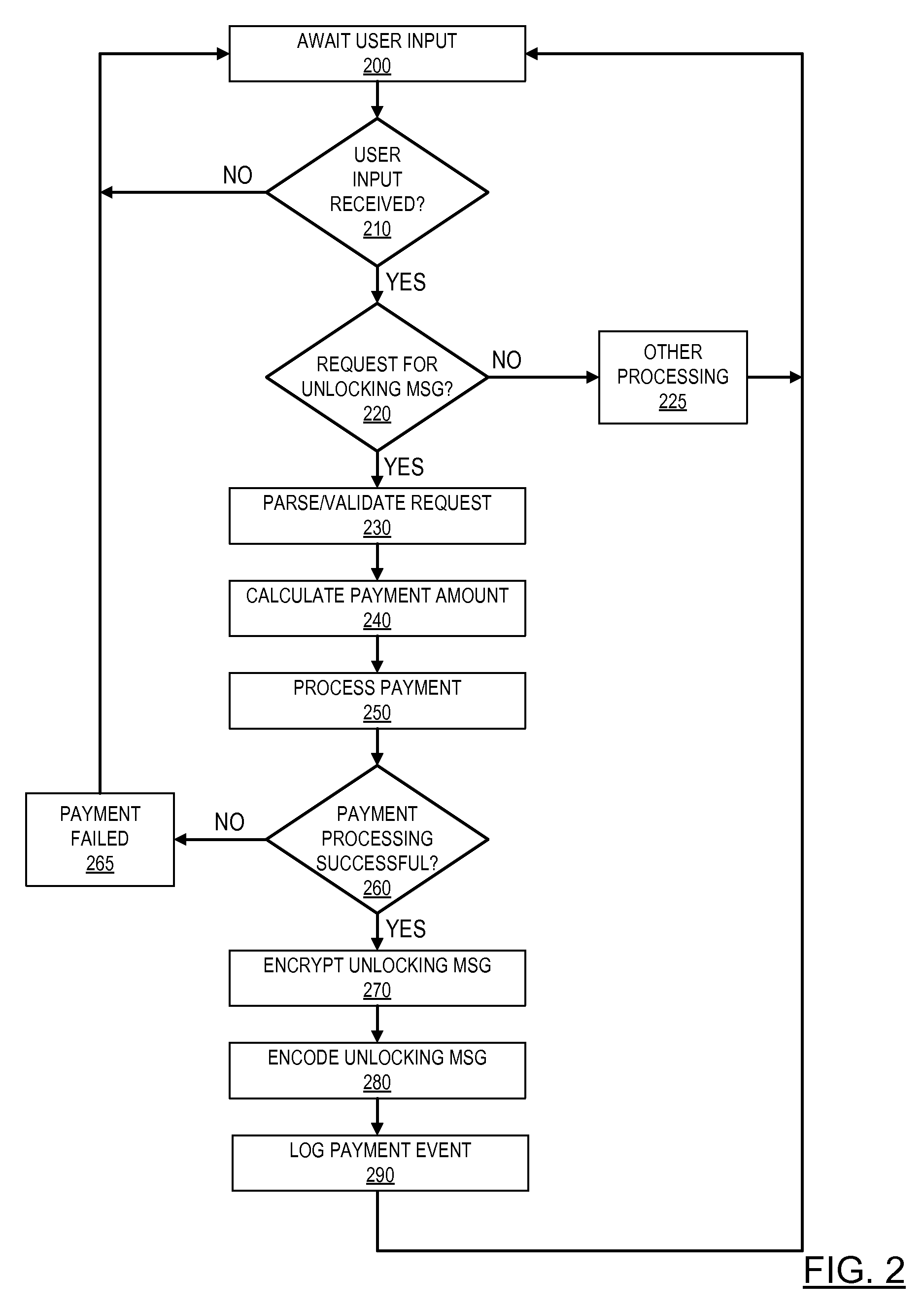

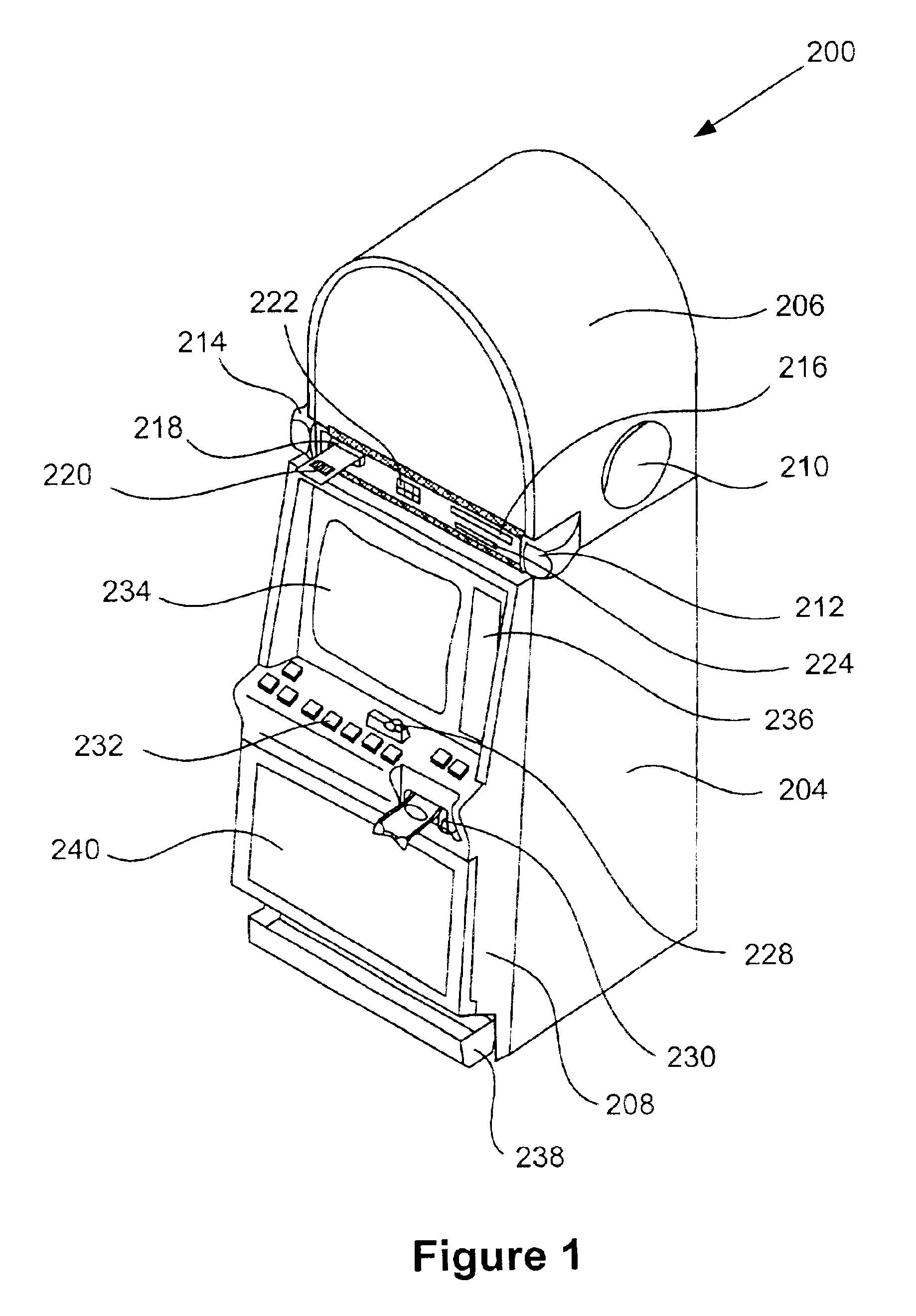

Pre-paid usage system for encoded information reading terminals

A fleet management system for managing a fleet of encoded information reading (EIR) terminals can comprise one or more computers, a fleet management software module, and a payment processing software module in communication with the fleet management software module. The fleet management software module can be configured, responsive to receiving a customer initiated request, to generate an unlocking message upon processing a payment by the payment processing software module. The unlocking message can be provided by a bar code to be read by an EIR terminal, or by a bit stream to be transferred to an EIR terminal via network. Each EIR terminal can be configured to perform not more than a pre-defined number of EIR operations responsive to receiving the unlocking message.

Owner:METROLOGIC INSTR

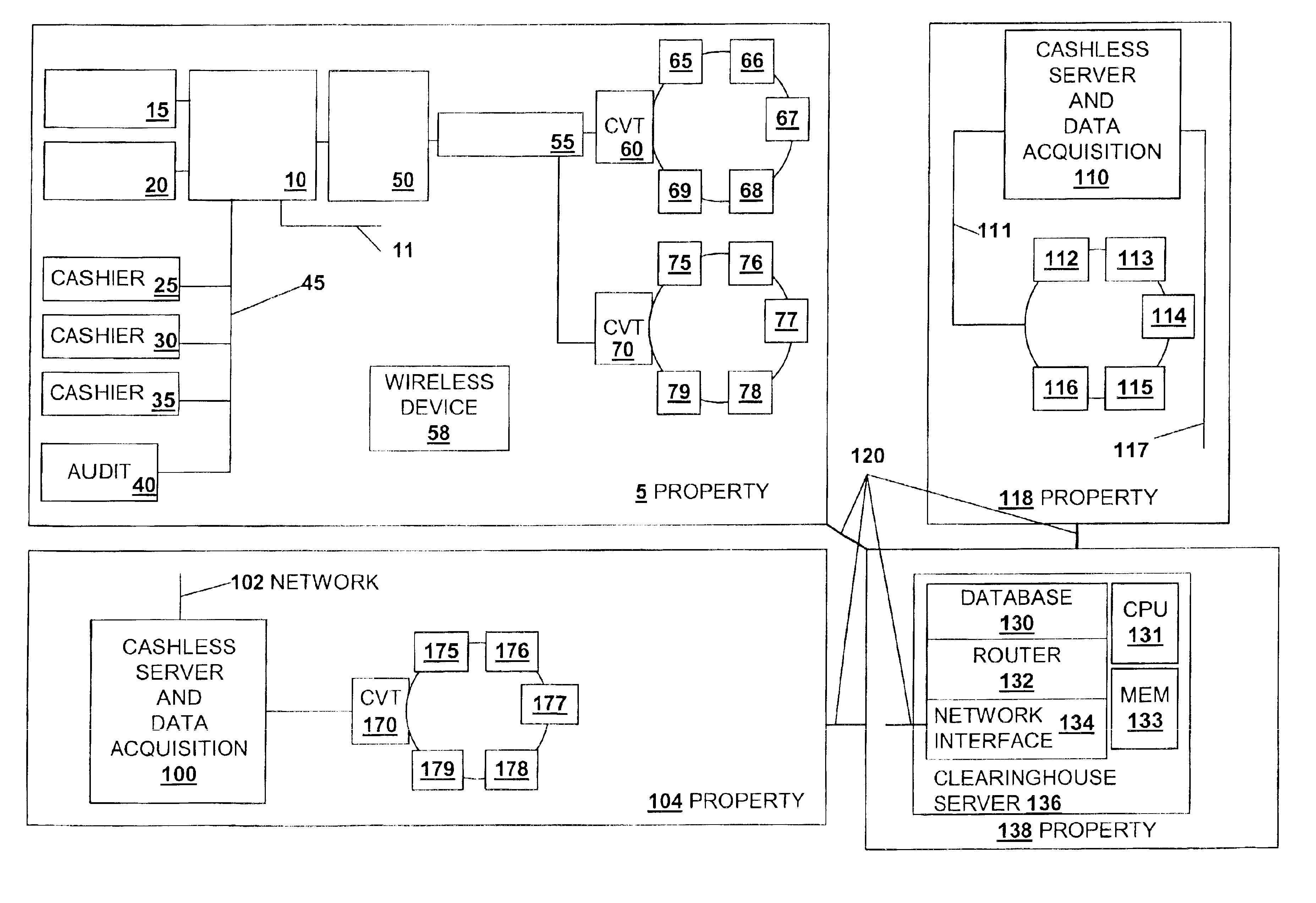

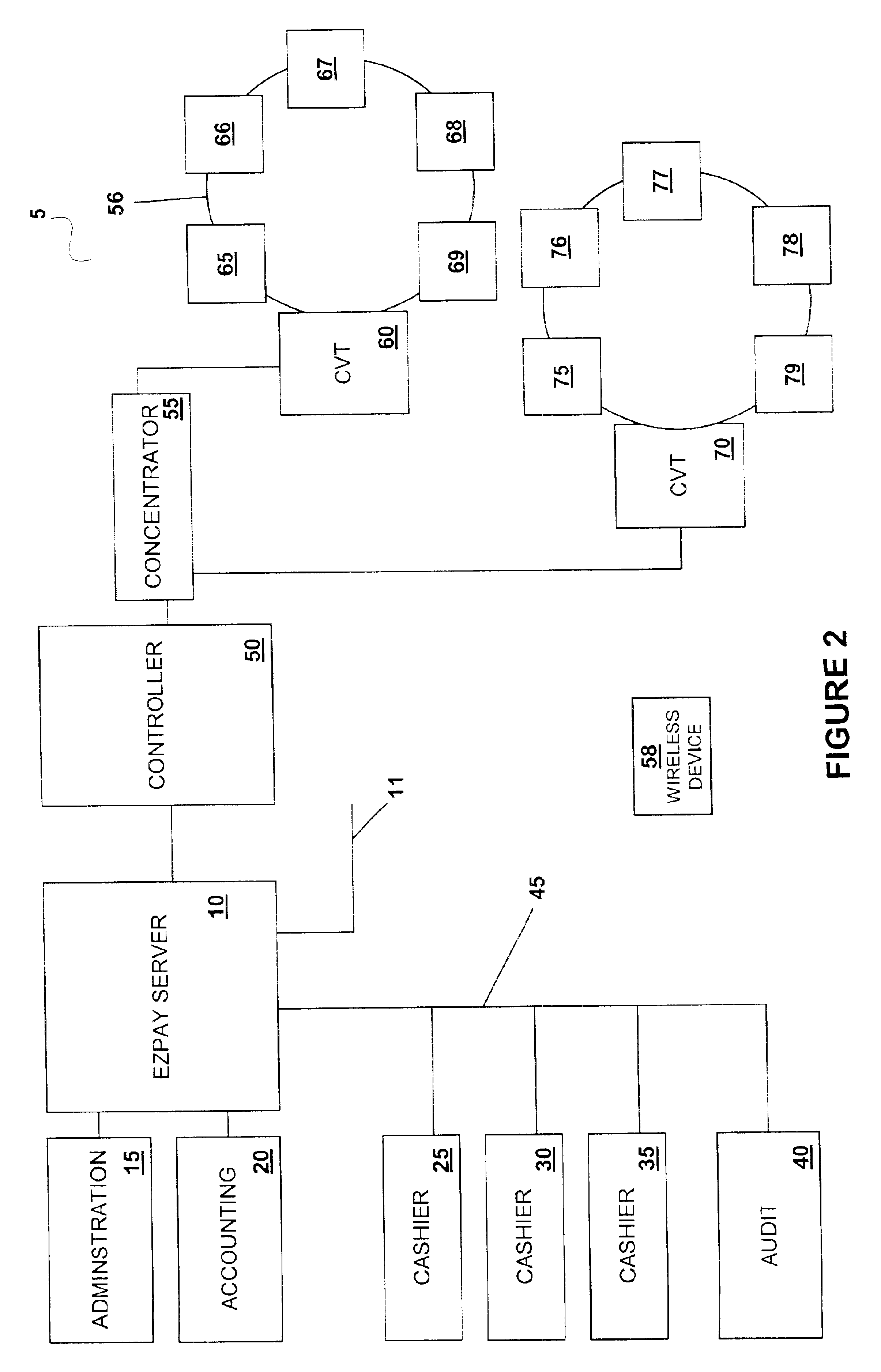

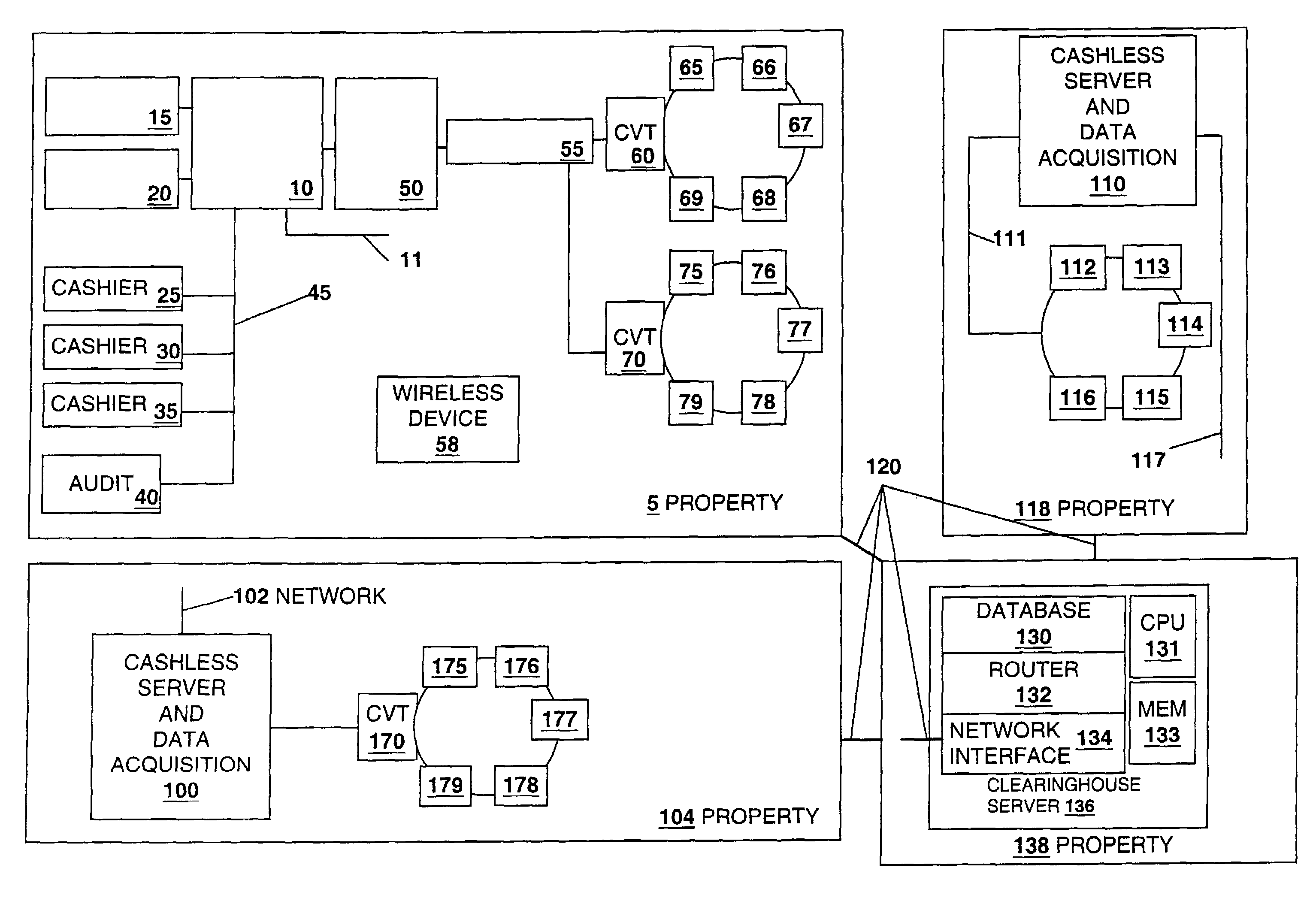

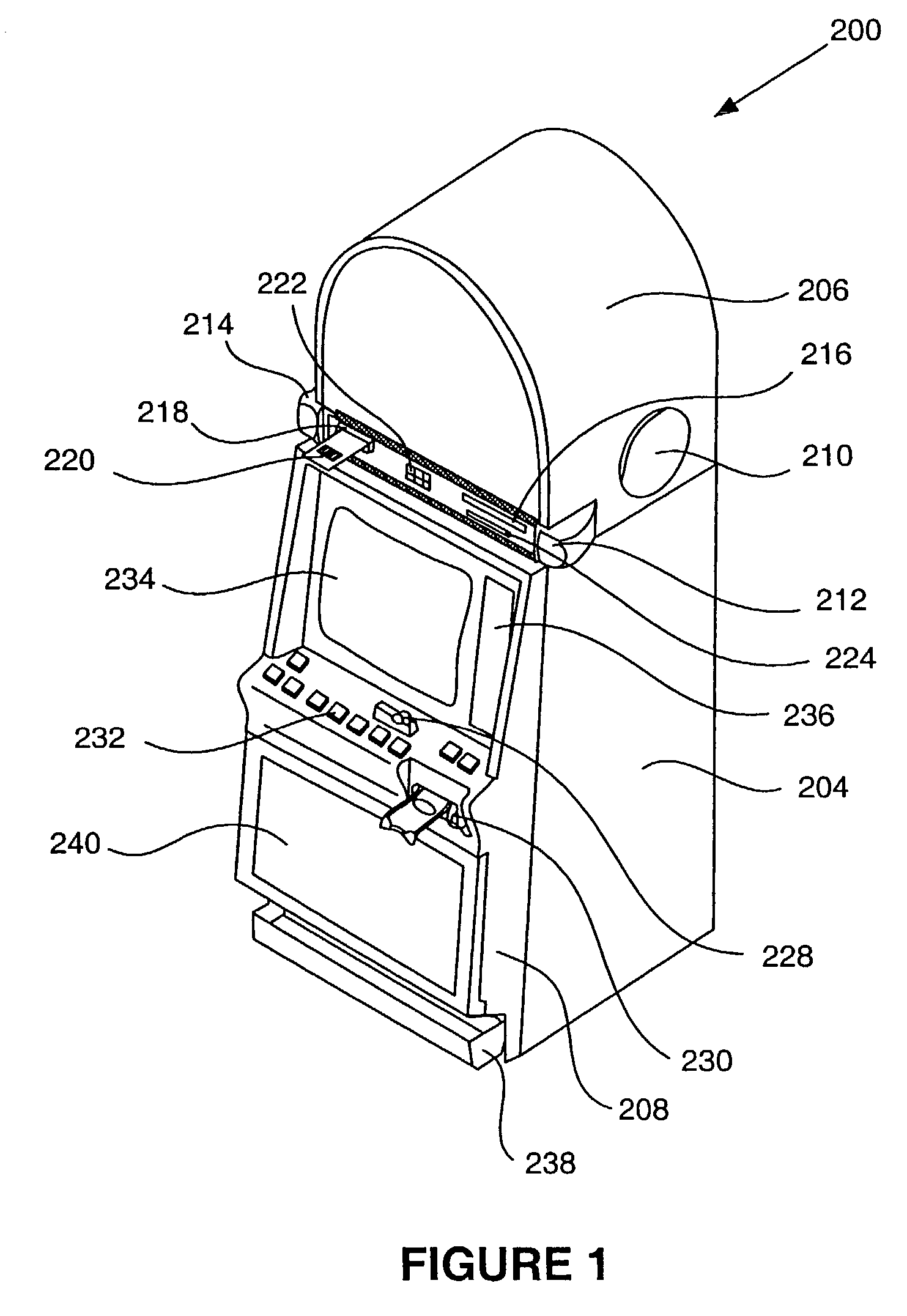

Cashless transaction clearinghouse

InactiveUS6866586B2Reduce the possibilityApparatus for meter-controlled dispensingPre-payment schemesEngineeringFinancial transaction

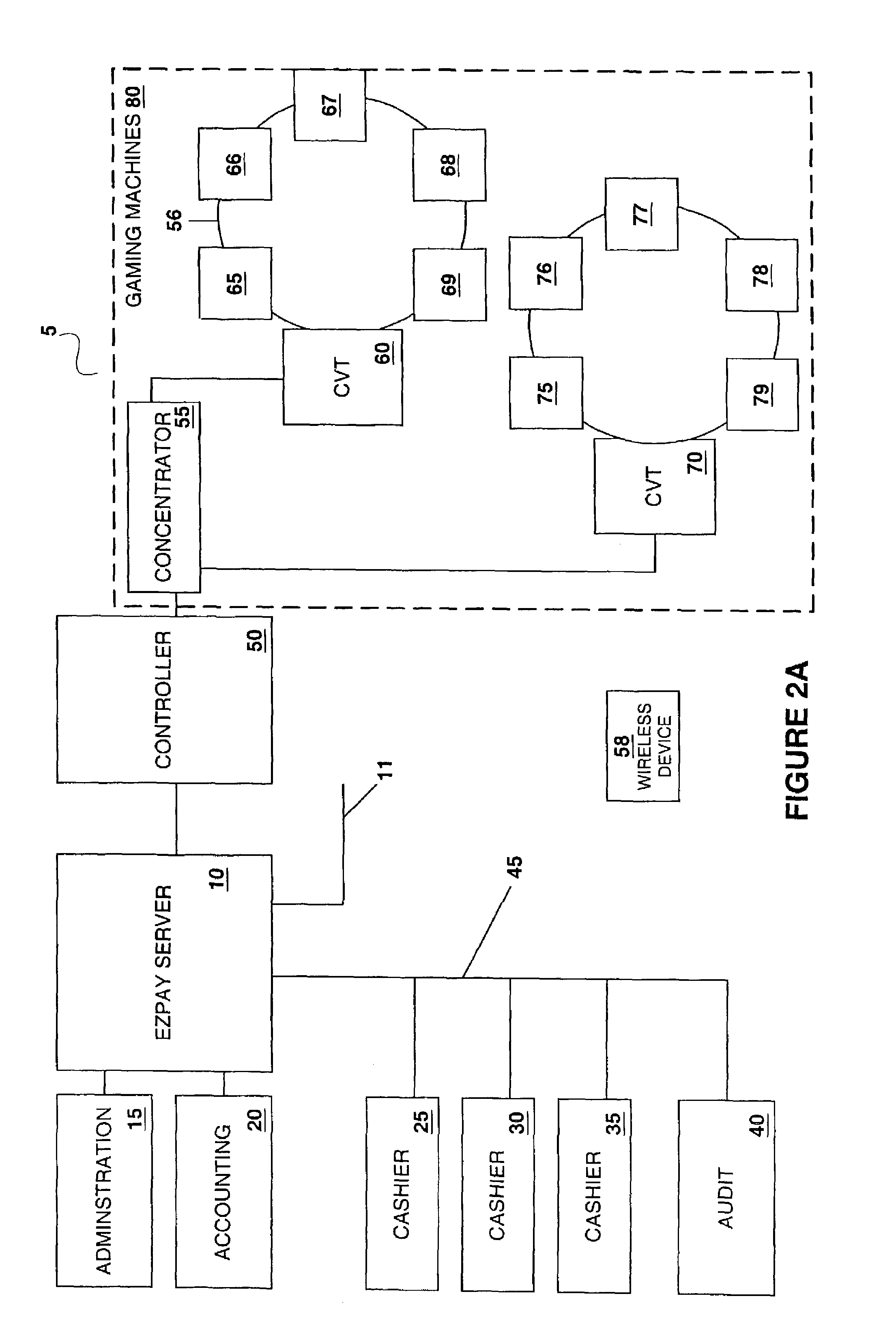

A disclosed cashless instrument transaction clearinghouse provides clearinghouse server including a network interface allowing the cashless instrument transaction clearinghouse to communicate with a number of gaming properties and a processor configured to enable the validation of cashless instruments at a gaming property different from where the cashless instrument was generated. Methods are provided that allow a plurality of cashless gaming devices located at different gaming properties to communicate with one another via the cashless instrument transaction clearinghouse in a secure manner using symmetric and asymmetric encryption techniques. Further, to reduce the possibilities of theft and fraud, the methods allow a receiver of a message to authenticate an identity of a sender of a message.

Owner:IGT

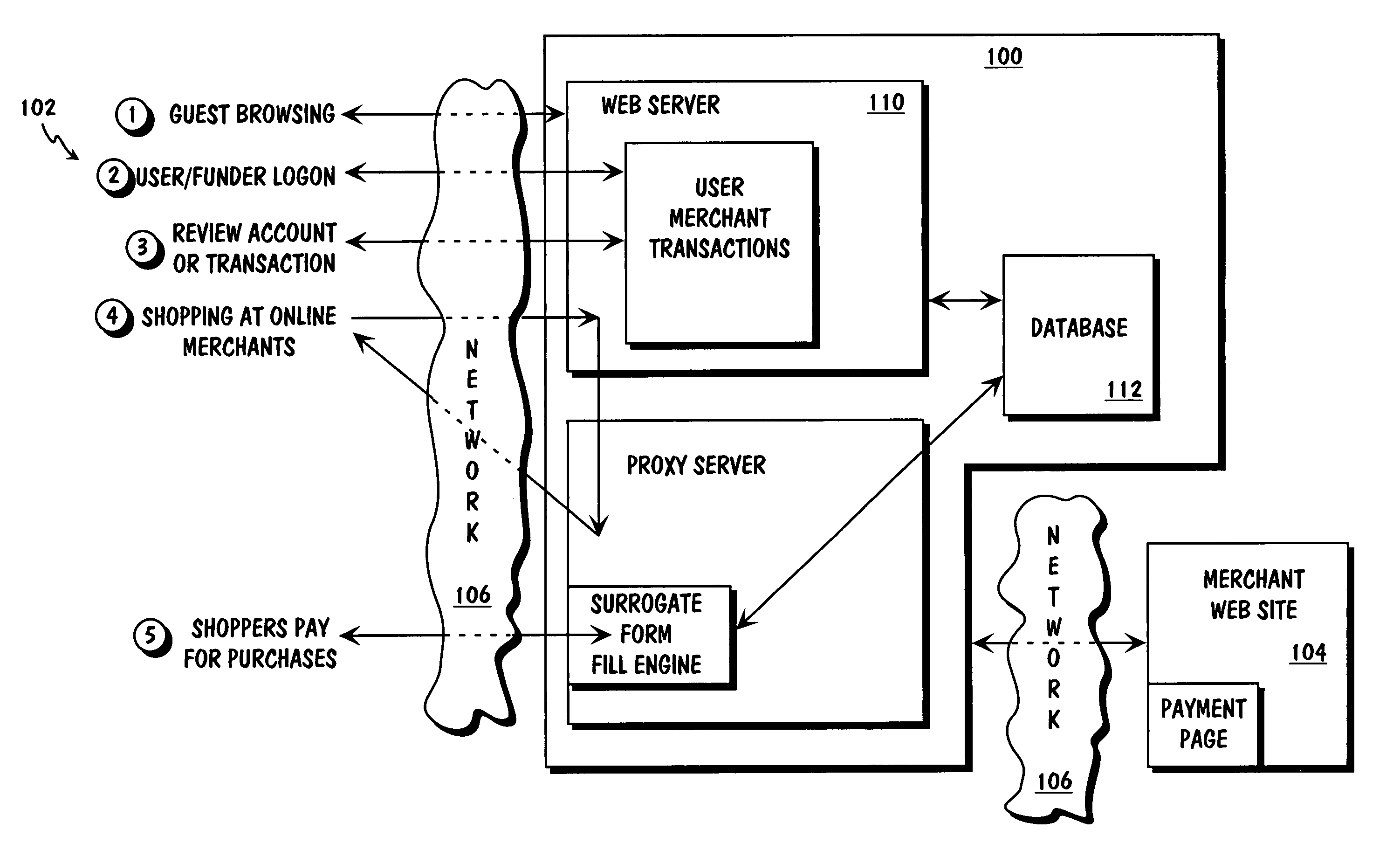

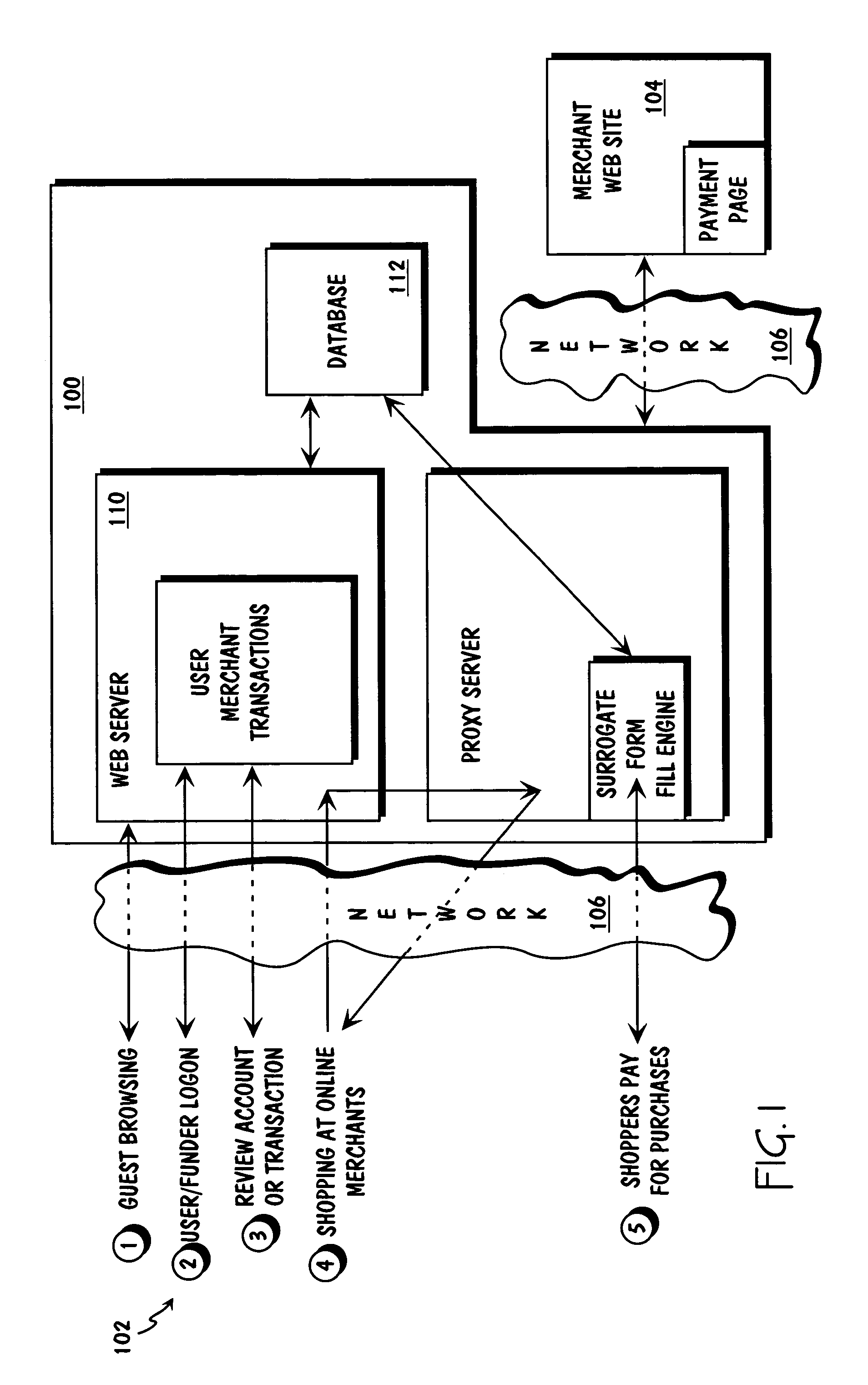

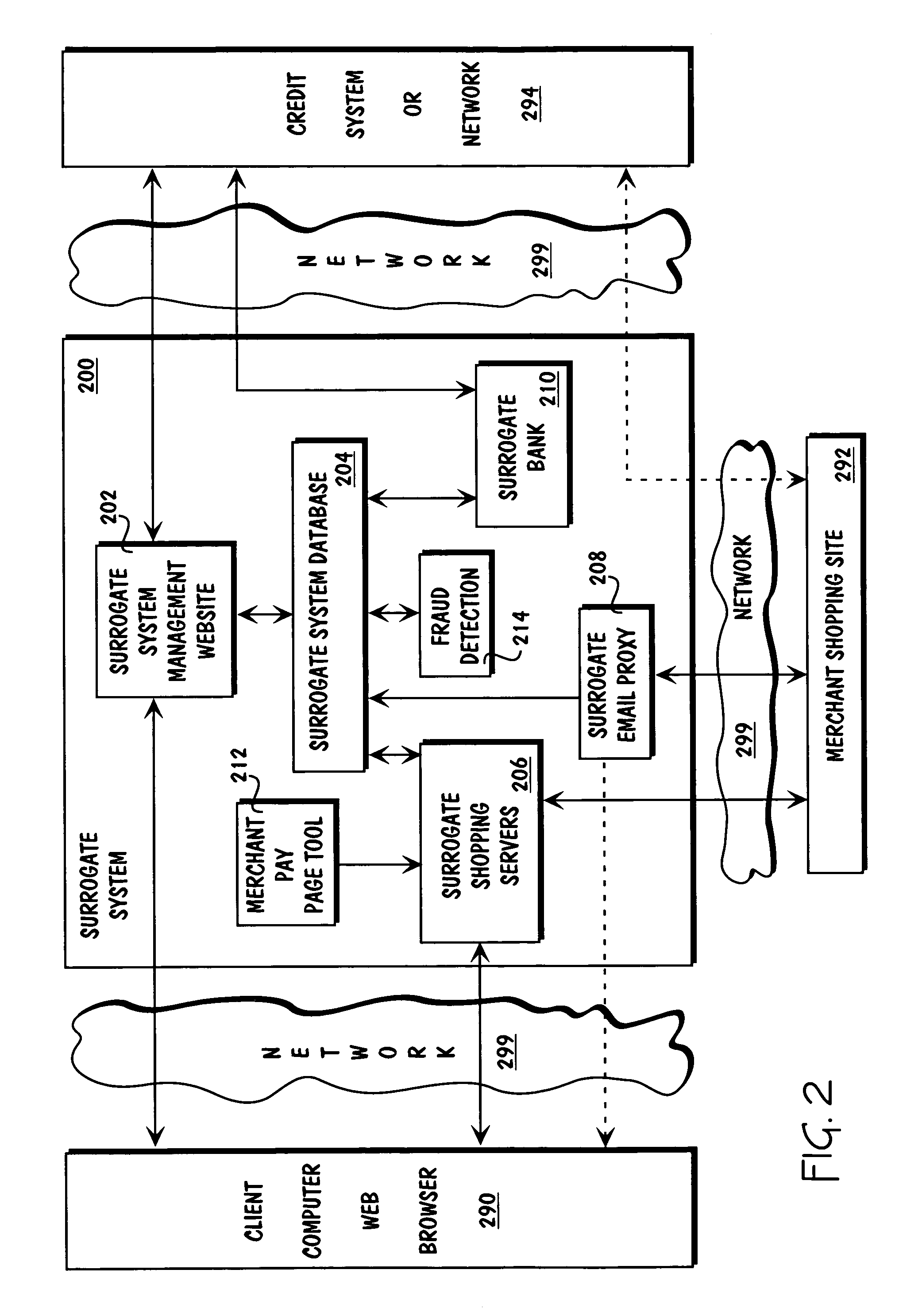

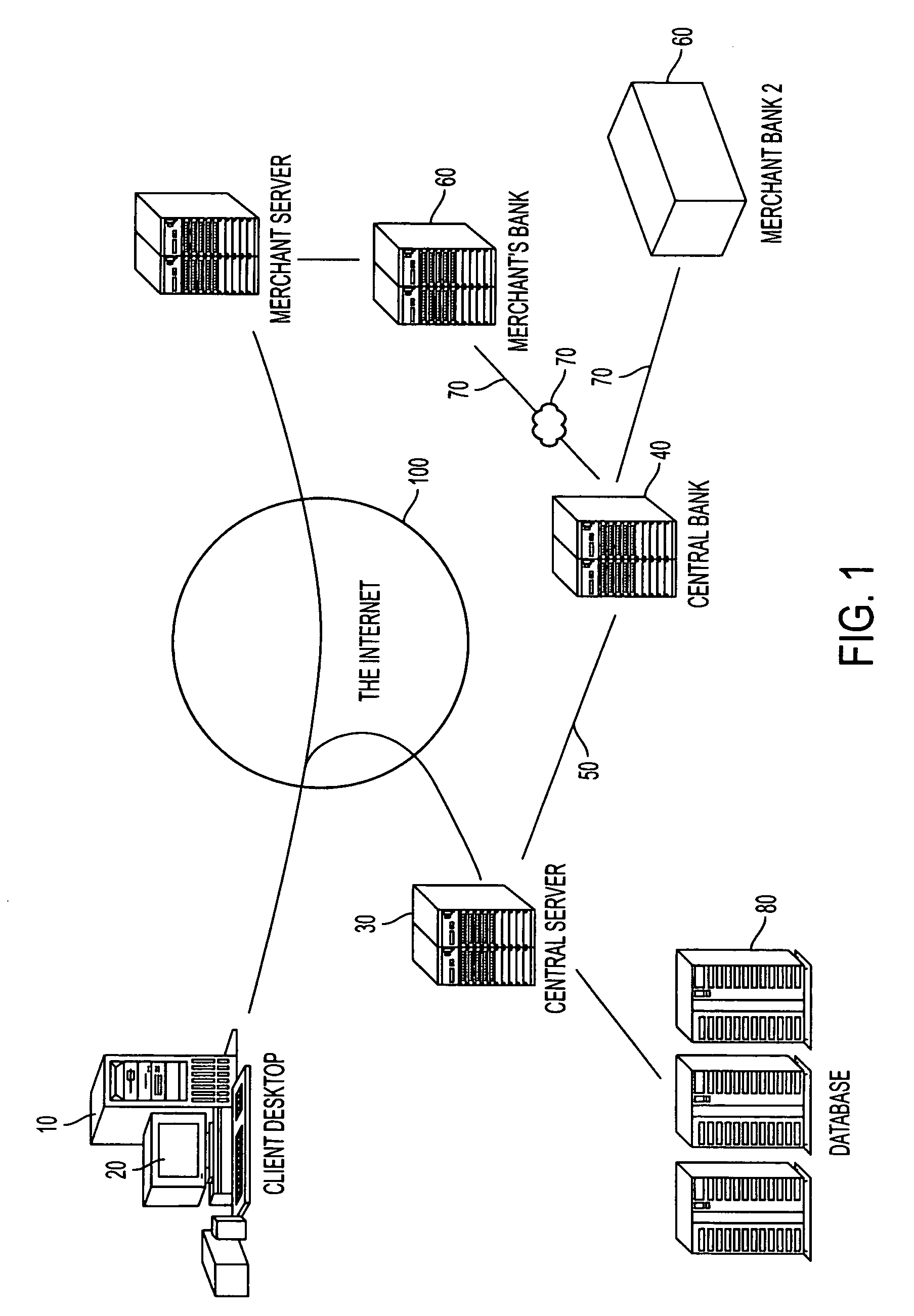

Method and apparatus for surrogate control of network-based electronic transactions

A surrogate system for the transparent control of electronic commerce transactions is provided through which an individual without a credit card is enabled to shop at online merchant sites. Upon opening an account within the surrogate system, the account can be funded using numerous fund sources, for example credit cards, checking accounts, money orders, gift certificates, incentive codes, online currency, coupons, and stored value cards. A user with a funded account can shop at numerous merchant web sites through the surrogate system. When merchandise is selected for purchase, a purchase transaction is executed in which a credit card belonging to the surrogate system is temporarily or permanently assigned to the user. The credit card, once loaded with funds from the user's corresponding funded account, is used to complete the purchase transaction. The surrogate system provides controls that include monitoring the data streams and, in response, controlling the information flow between the user and the merchant sites.

Owner:THE COCA-COLA CO

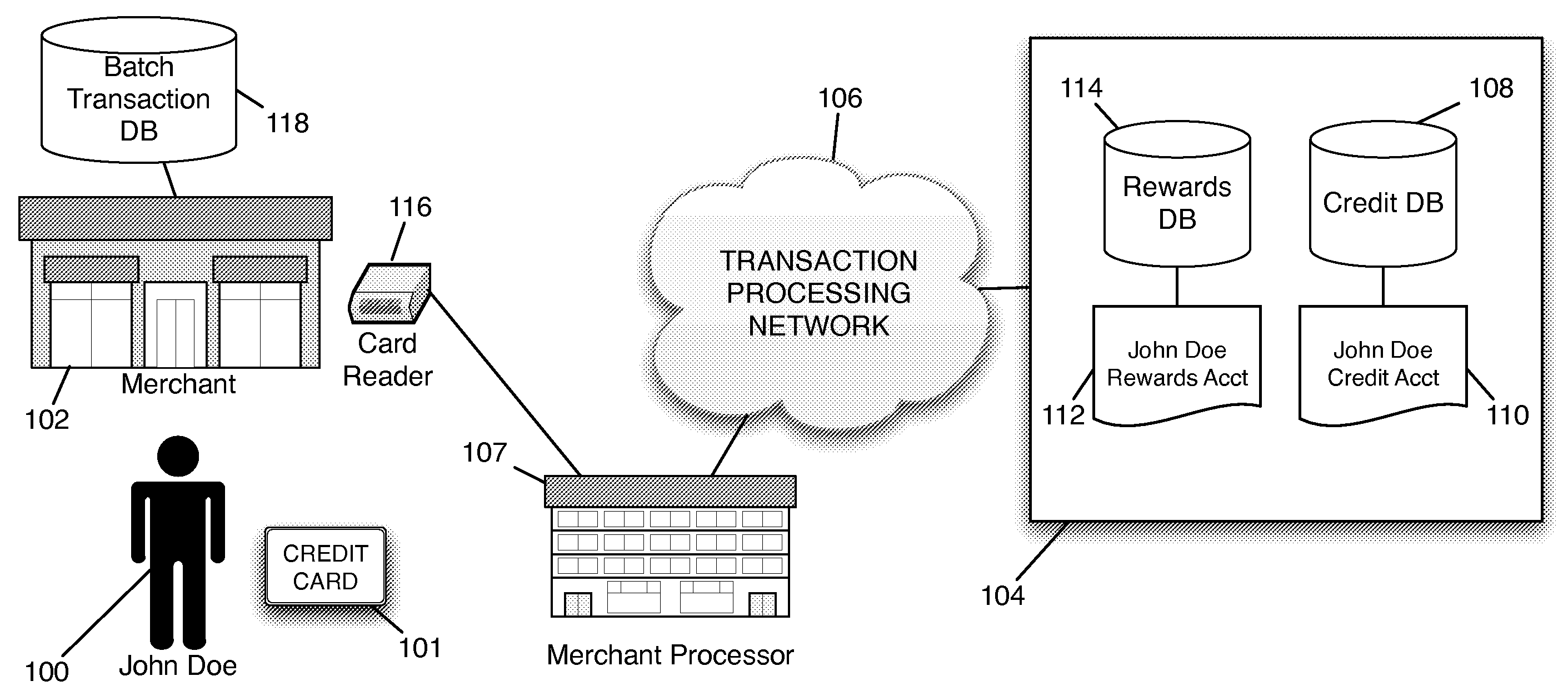

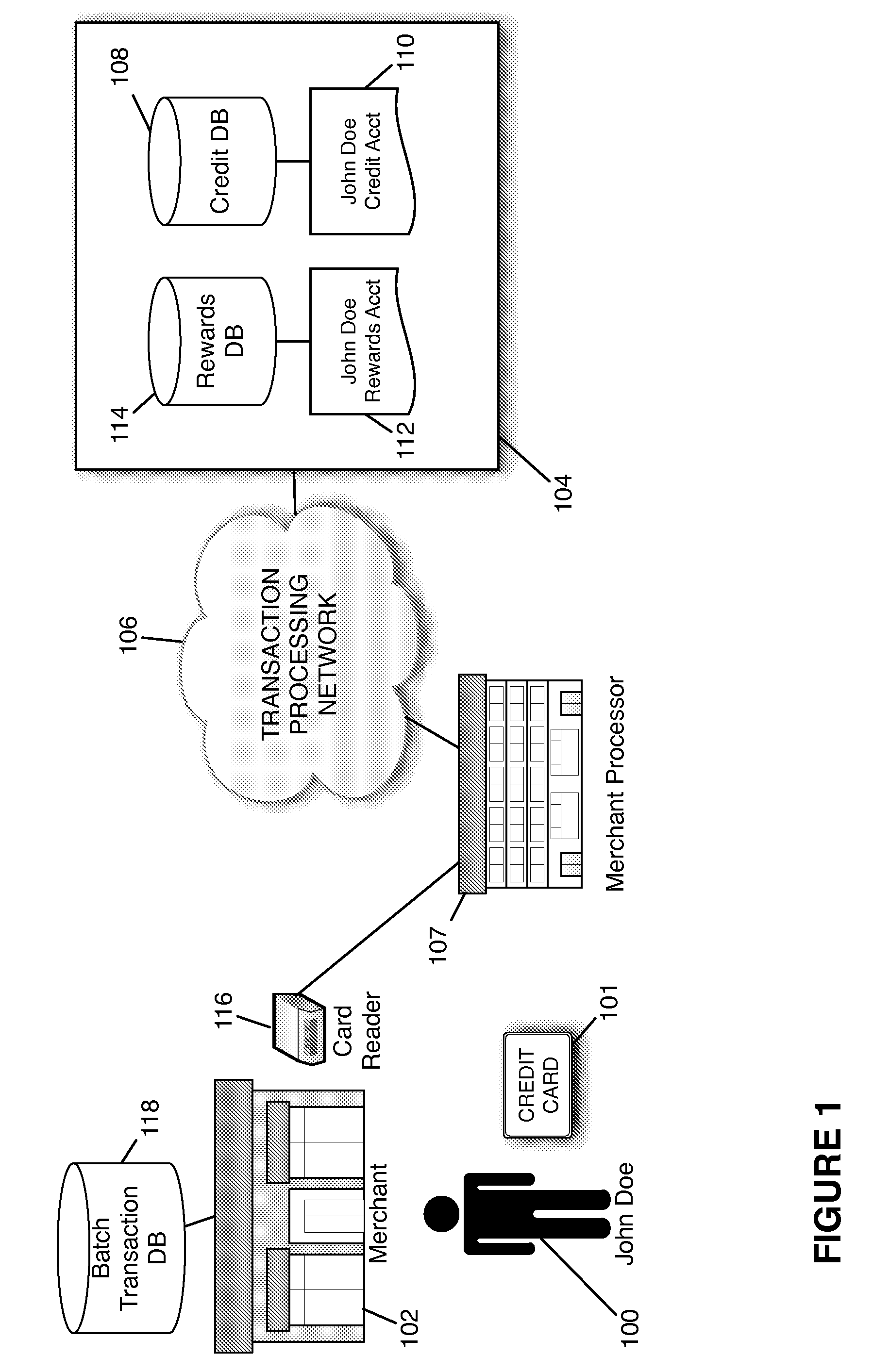

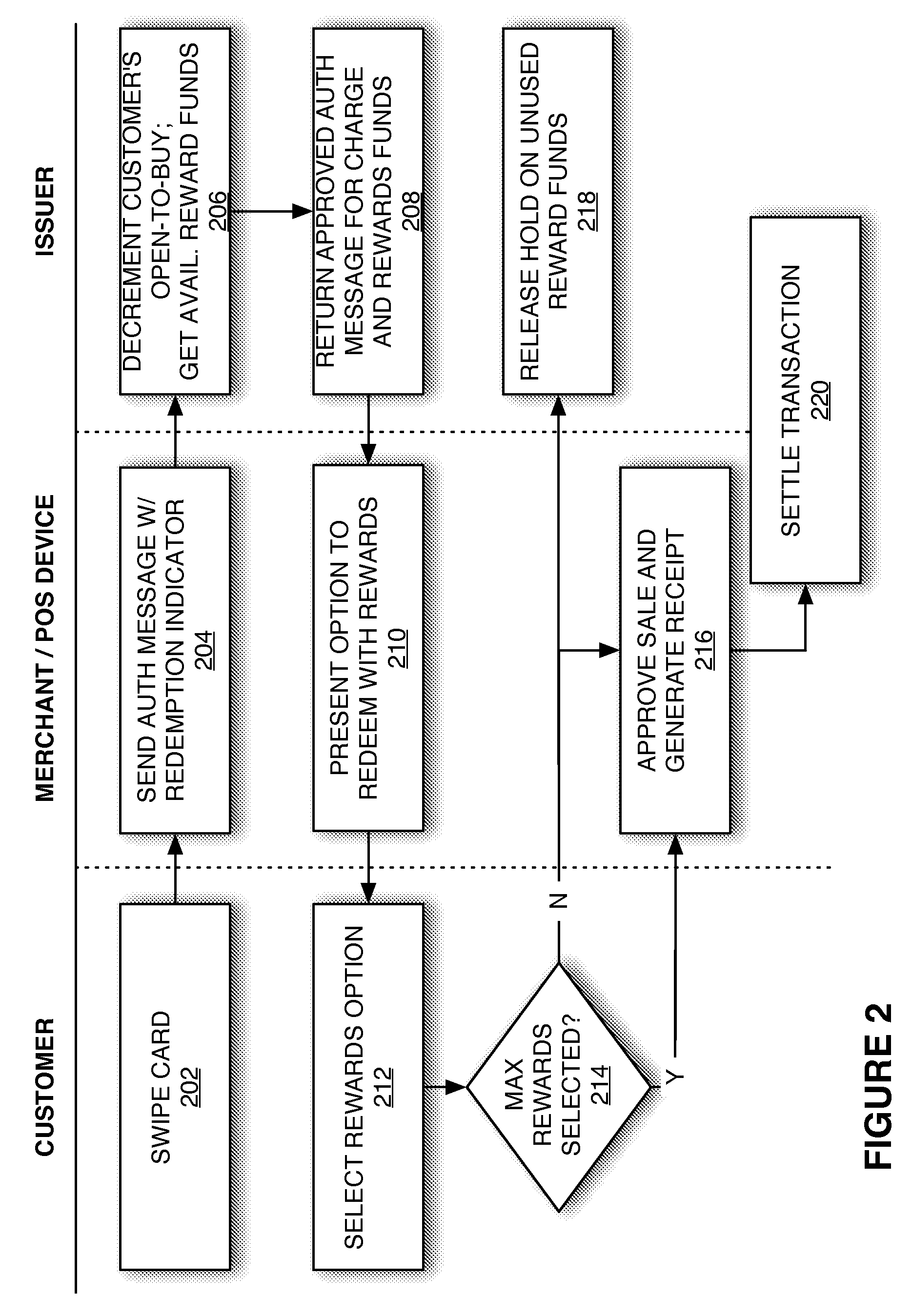

Redemption of Credit Card Rewards at a Point of Sale

Systems and methods are described for redeeming rewards at a merchant's point-of-sale. The reward redemption takes place in real time and can be accomplished without the active participation of the merchant. A single credit card with no additional information may be used with a single swipe from the consumer to access both credit and rewards accounts, such that a single authorization request is made to encompass both rewards and credit. Merchants can be fully compensated for transactions by the issuer despite the customer's choice to redeem rewards.

Owner:DFS SERVICES

Credit cards system and method having additional features

InactiveUS20090037333A1Complete banking machinesCredit registering devices actuationCredit cardComputer hardware

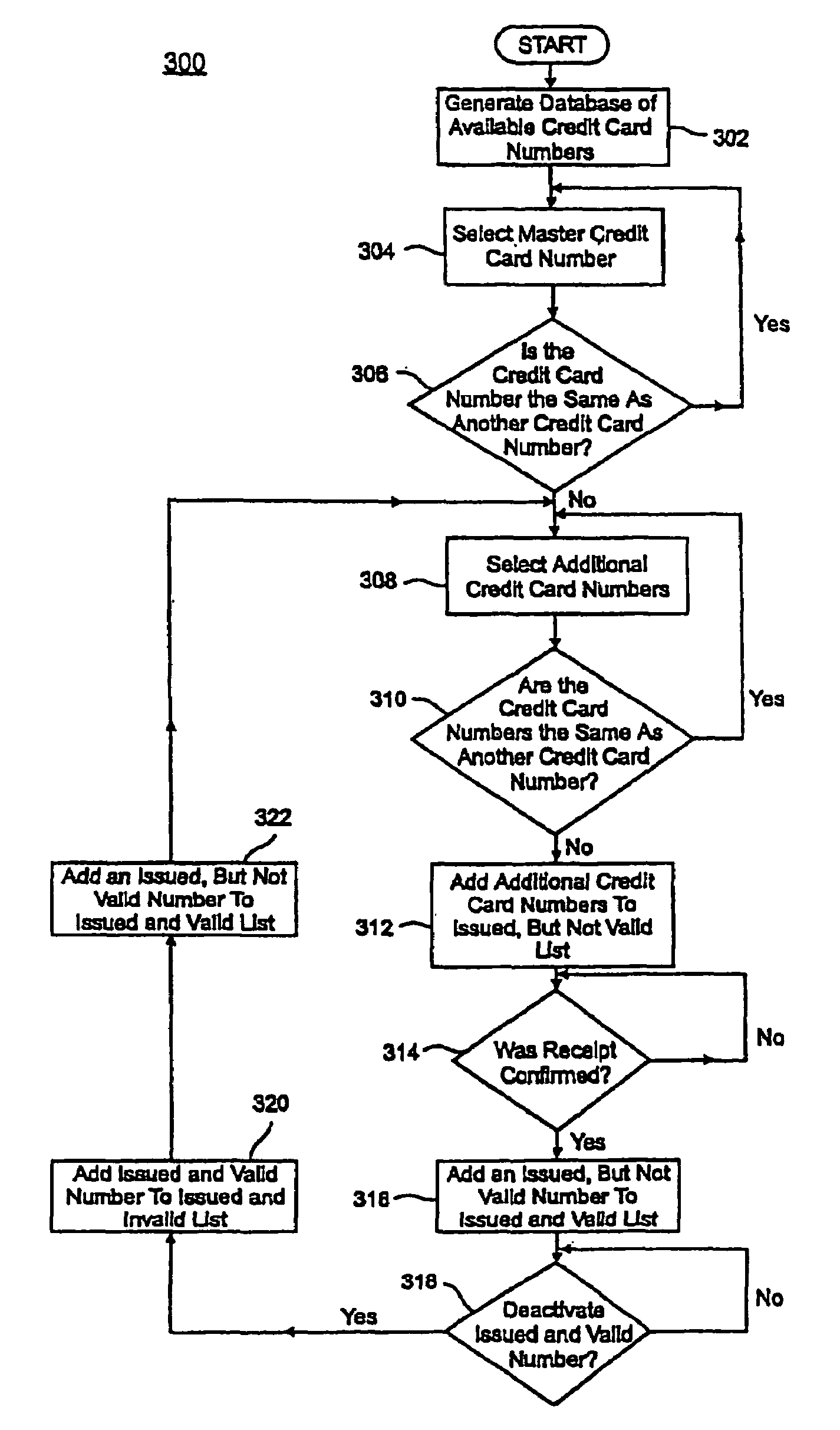

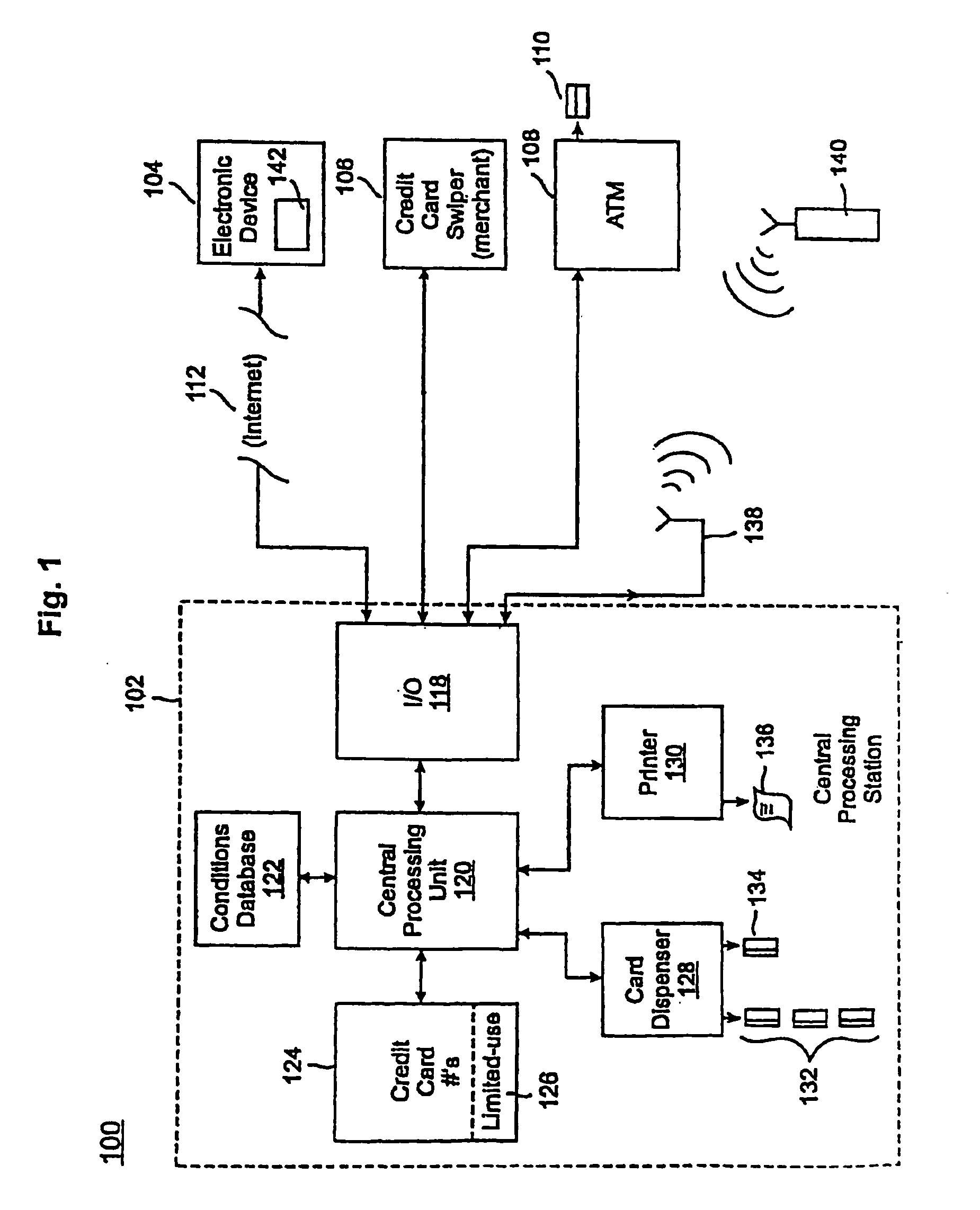

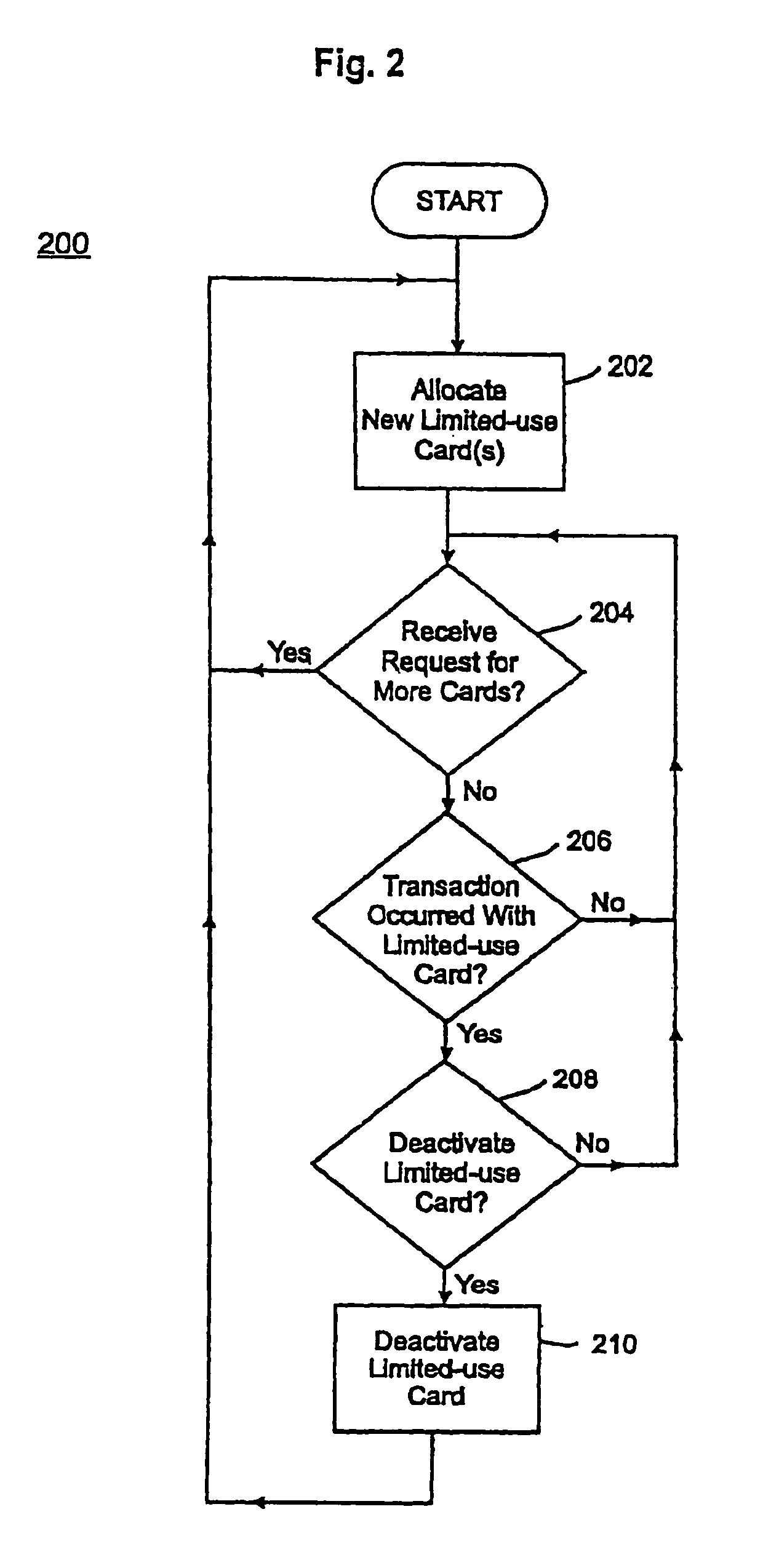

A credit card system is provided which has the added feature of providing additional limited use credit card numbers and / or cards. These numbers and / or cards can be used for a single or limited use transaction, thereby reducing the potential for fraudulent reuse of these numbers and / or cards. The credit card system finds application to “card remote” transactions such as by phone or Internet. Additionally, when a single use or limited use credit card is used for “card present” transactions, so called “skimming” fraud is eliminated. Various other features enhance the credit card system, which will allow secure trade without the use of elaborate encryption techniques. Methods for limiting, distributing and using a limited use card number, controlling the validity of a limited use credit card number, conducting a limited use credit card number transaction and providing remote access devices for accessing a limited use credit card number are also provided.

Owner:ORBIS PATENTS

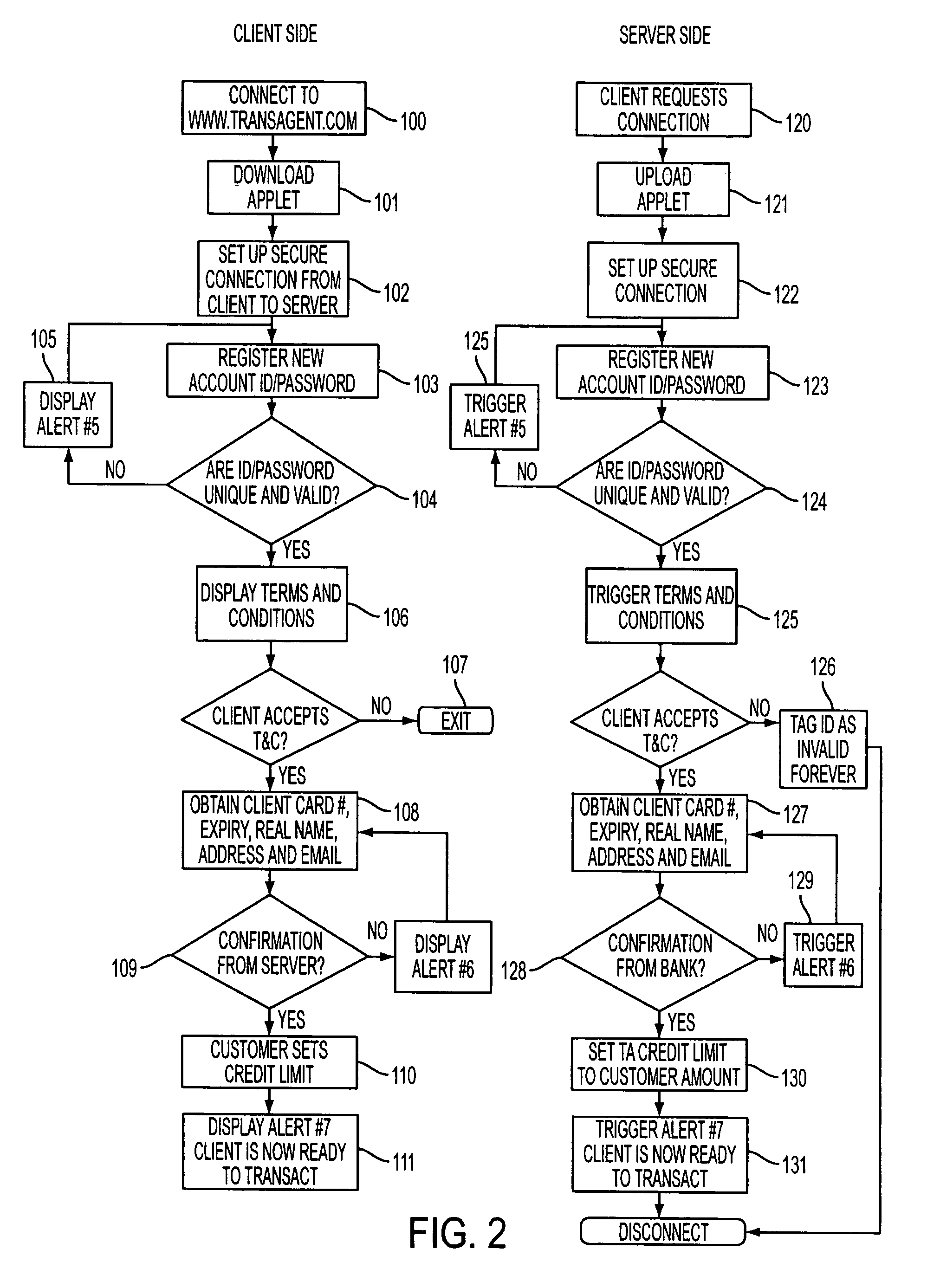

Secure online commerce transactions

A method of enabling electronic commerce transactions is provided by a service, the service giving to users a disposable credit card or other indicia of credit for a particular transaction or amount. The service receives registration information from the user and authorizes the user. The service establishes an account for the user and issues a disposable (one use) credit card number to the user which has the same format as a permanent credit card number, is acceptable to the user and the institution with whom the user is transacting business. The system incorporates various security features.

Owner:ACEINC PTY LTD

Cashless transaction clearinghouse

InactiveUS7419428B2Credit registering devices actuationApparatus for meter-controlled dispensingMulti siteInformation access

A disclosed cashless instrument transaction clearinghouse includes a network interface allowing the cashless instrument transaction clearinghouse to communicate with a number of gaming properties and a processor configured to enable the validation of cashless instruments at a gaming property different from where the cashless instrument was generated. Methods are provided at the cashless instrument transaction clearinghouse and at the gaming properties that enable cashless instrument transactions across multiple gaming properties including multi-site promotions. In addition, methods are provided at the cashless instrument transaction clearinghouse that allow 1) a transfer of resources from an account at a first gaming property to an account or device at a second gaming property, 2) account information access, 3) generation of cashless transaction threads comprising a plurality of related cashless transaction, 4) awards and services based upon properties of a cashless transaction thread and 5) local resource accounts maintained at the clearinghouse.

Owner:IGT

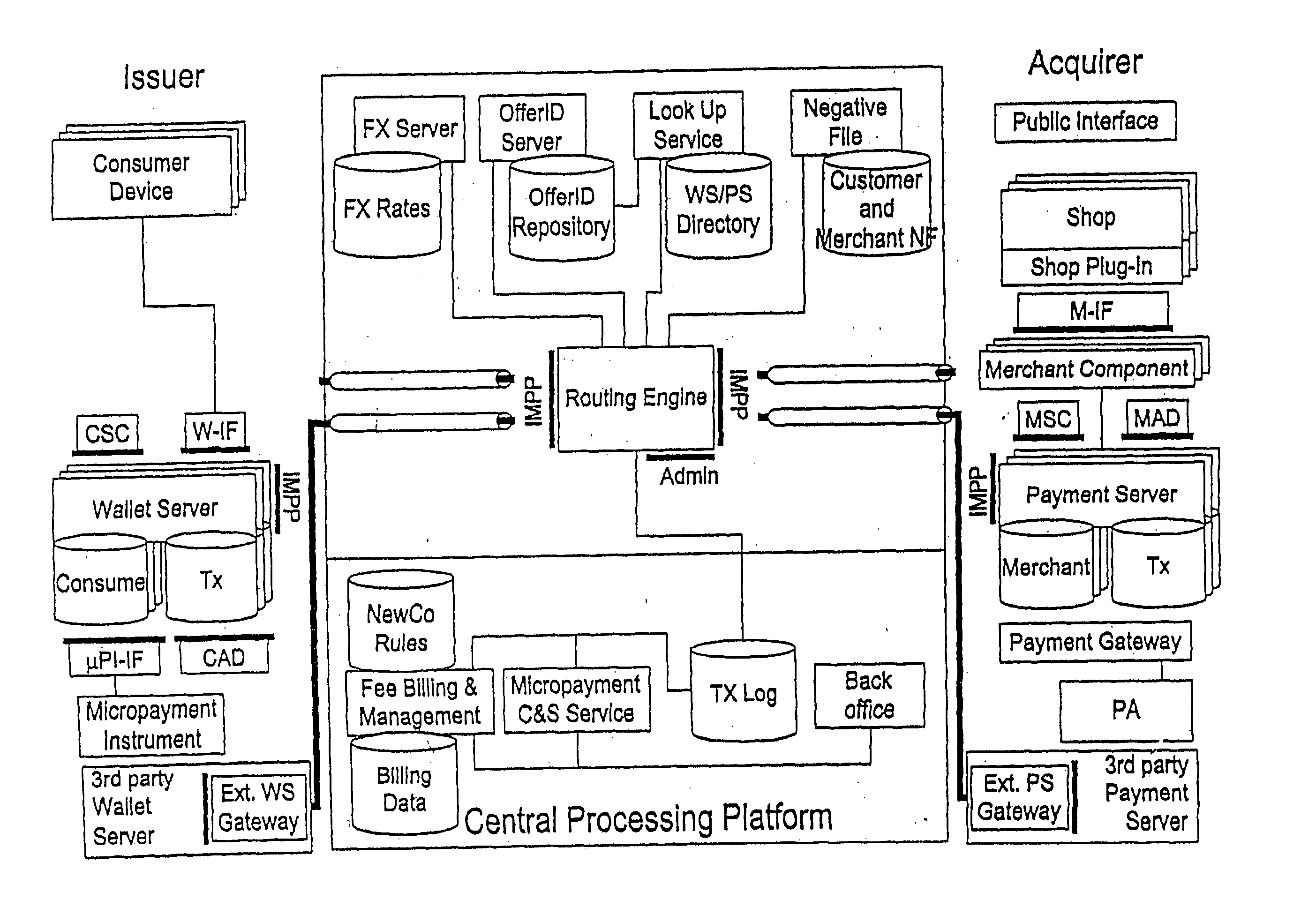

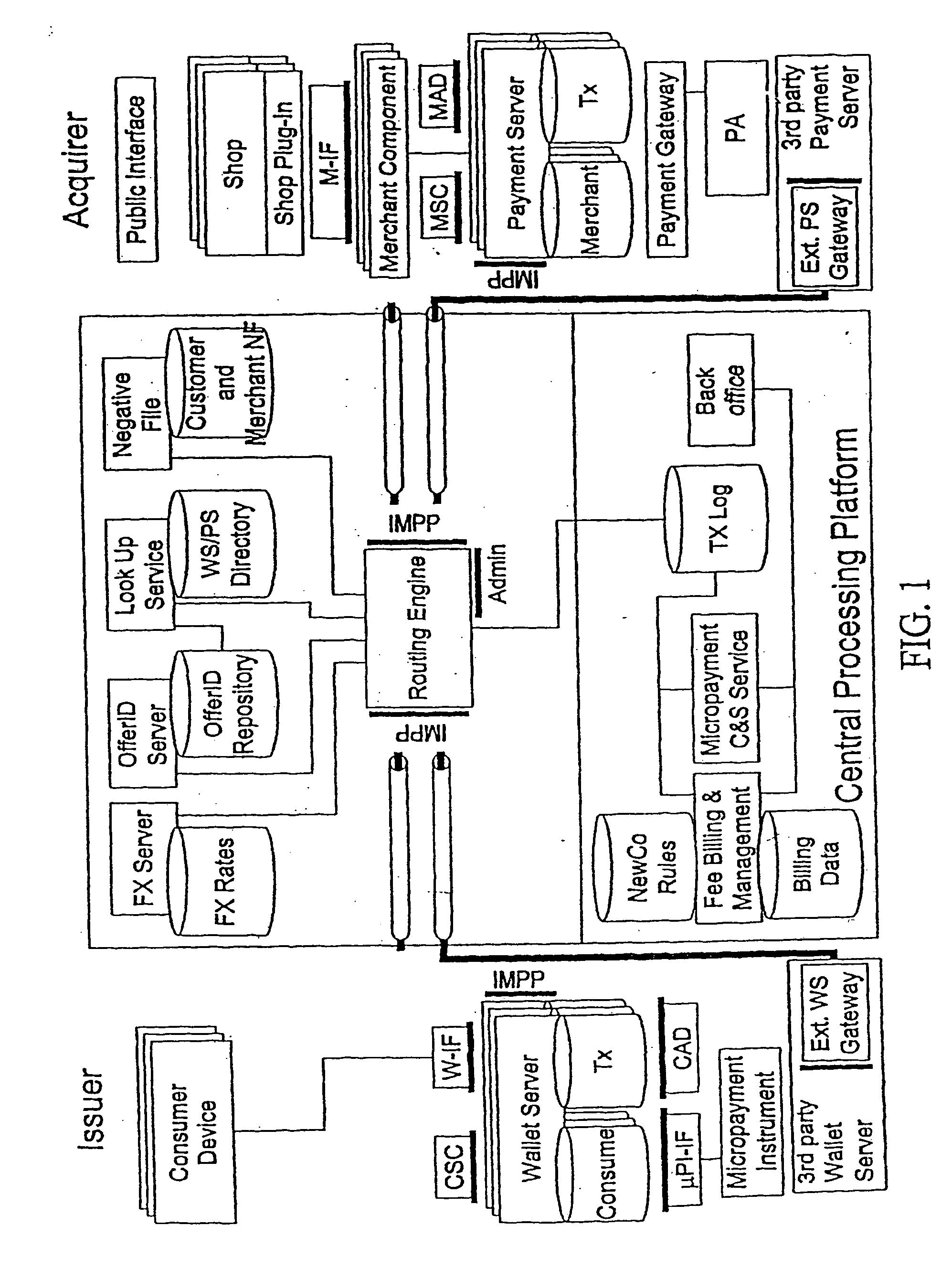

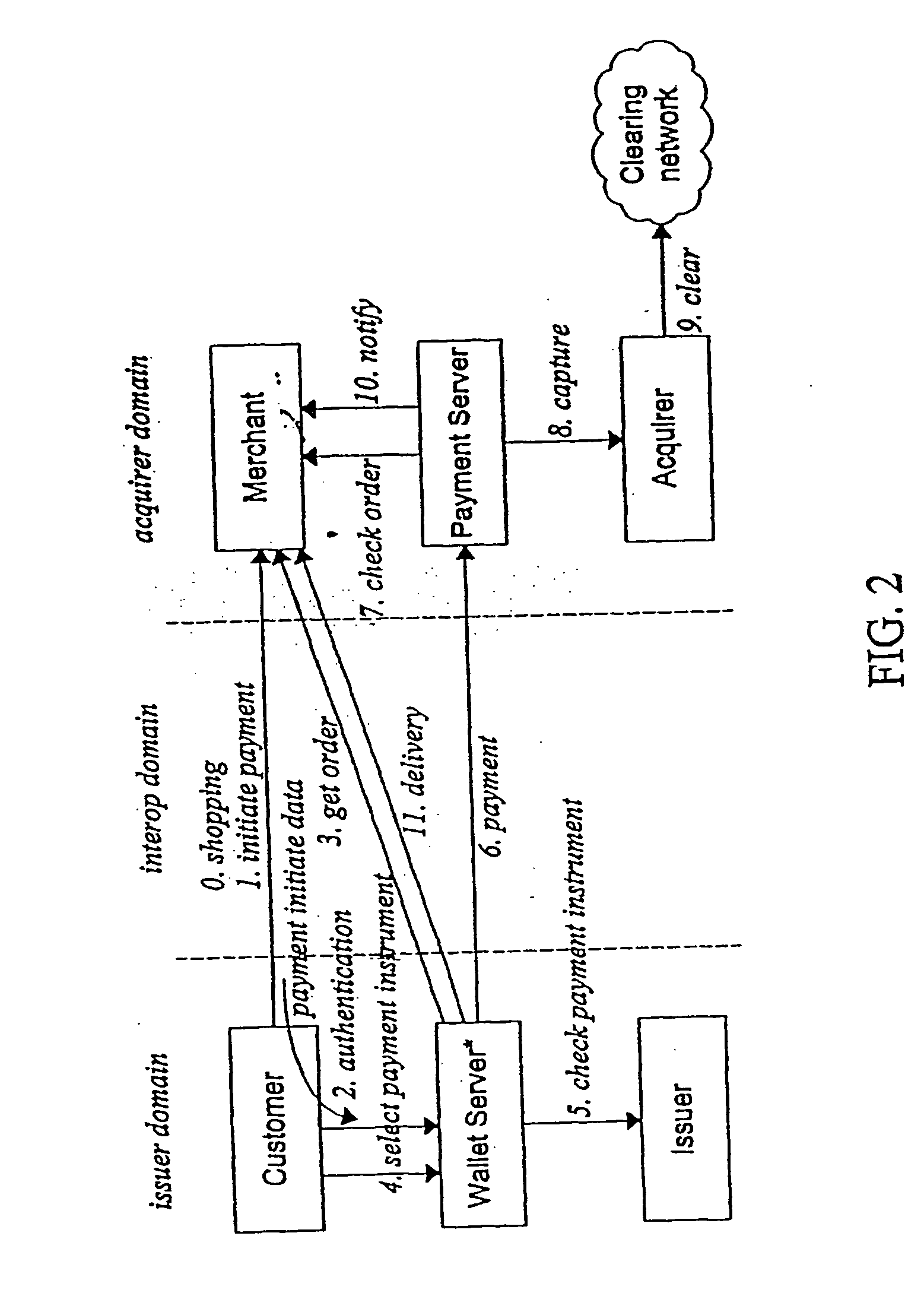

Payment protocol and data transmission method and data transmission device for conducting payment transactions

InactiveUS20050256802A1Avoid misleadingComplete banking machinesFinancePayment transactionData transmission

Owner:AMMERMANN DIRK +13

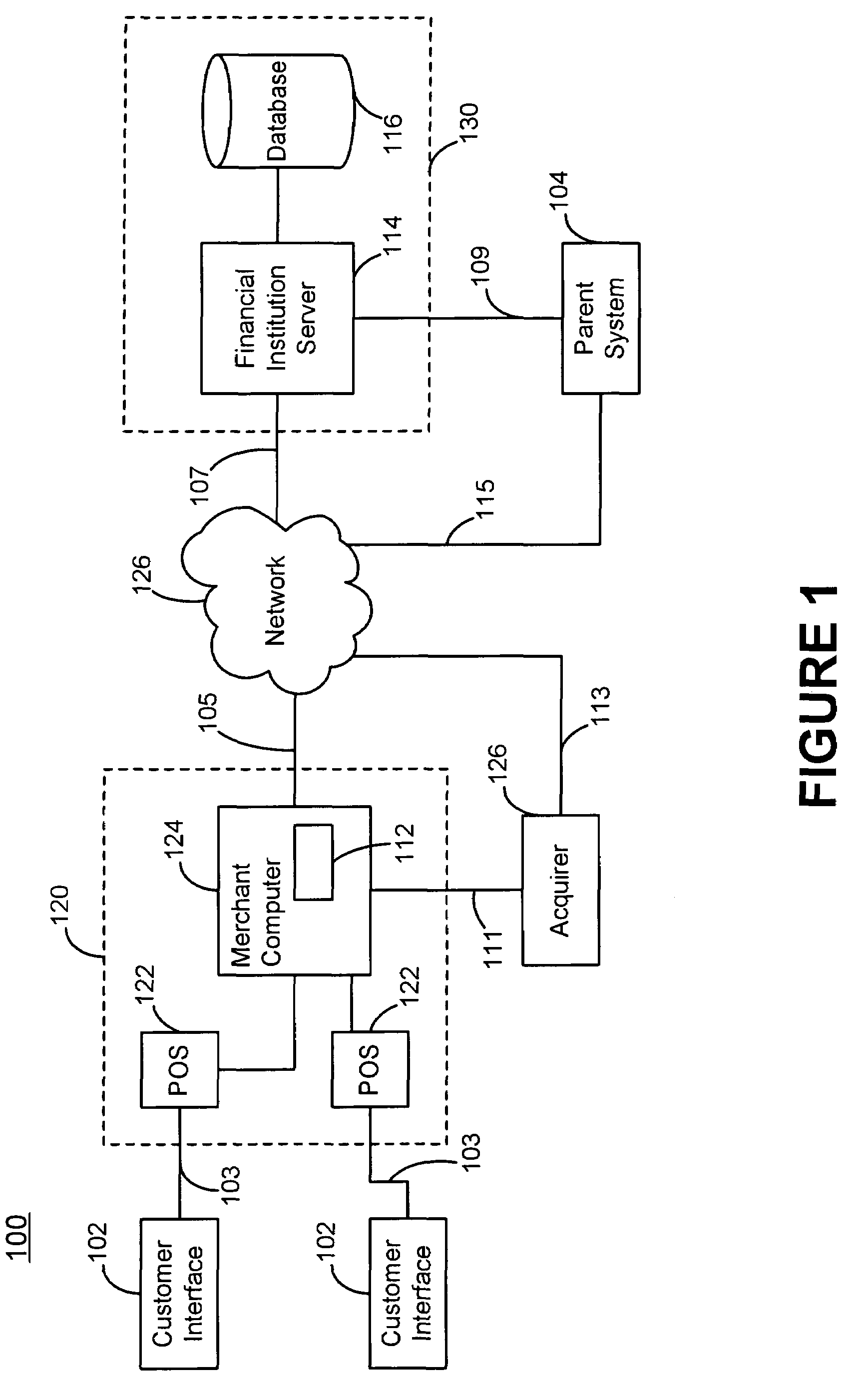

System and method for performing an on-line transaction using a single-use payment instrument

ActiveUS7398253B1Eliminate concernsCredit registering devices actuationFinanceCredit cardThe Internet

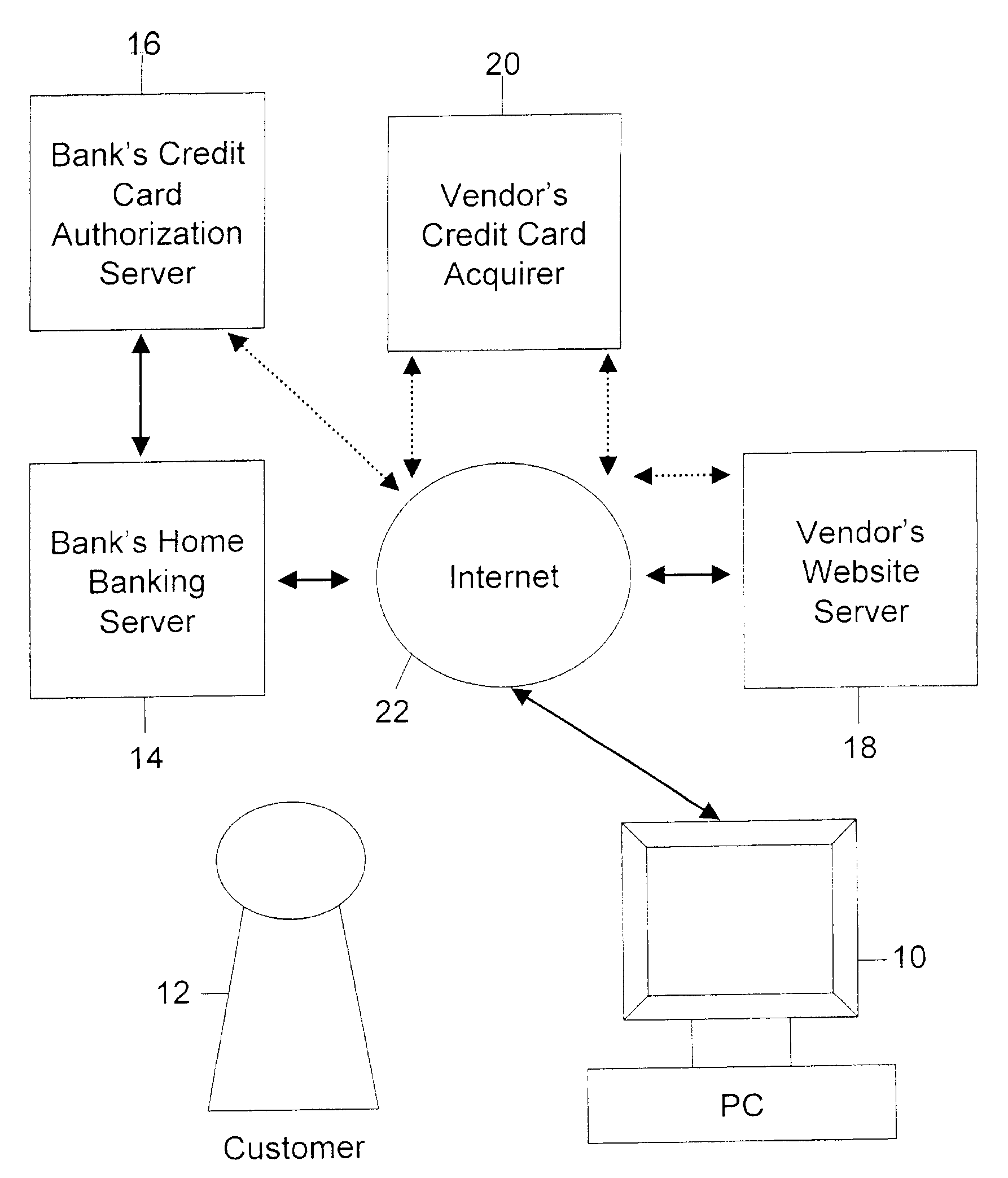

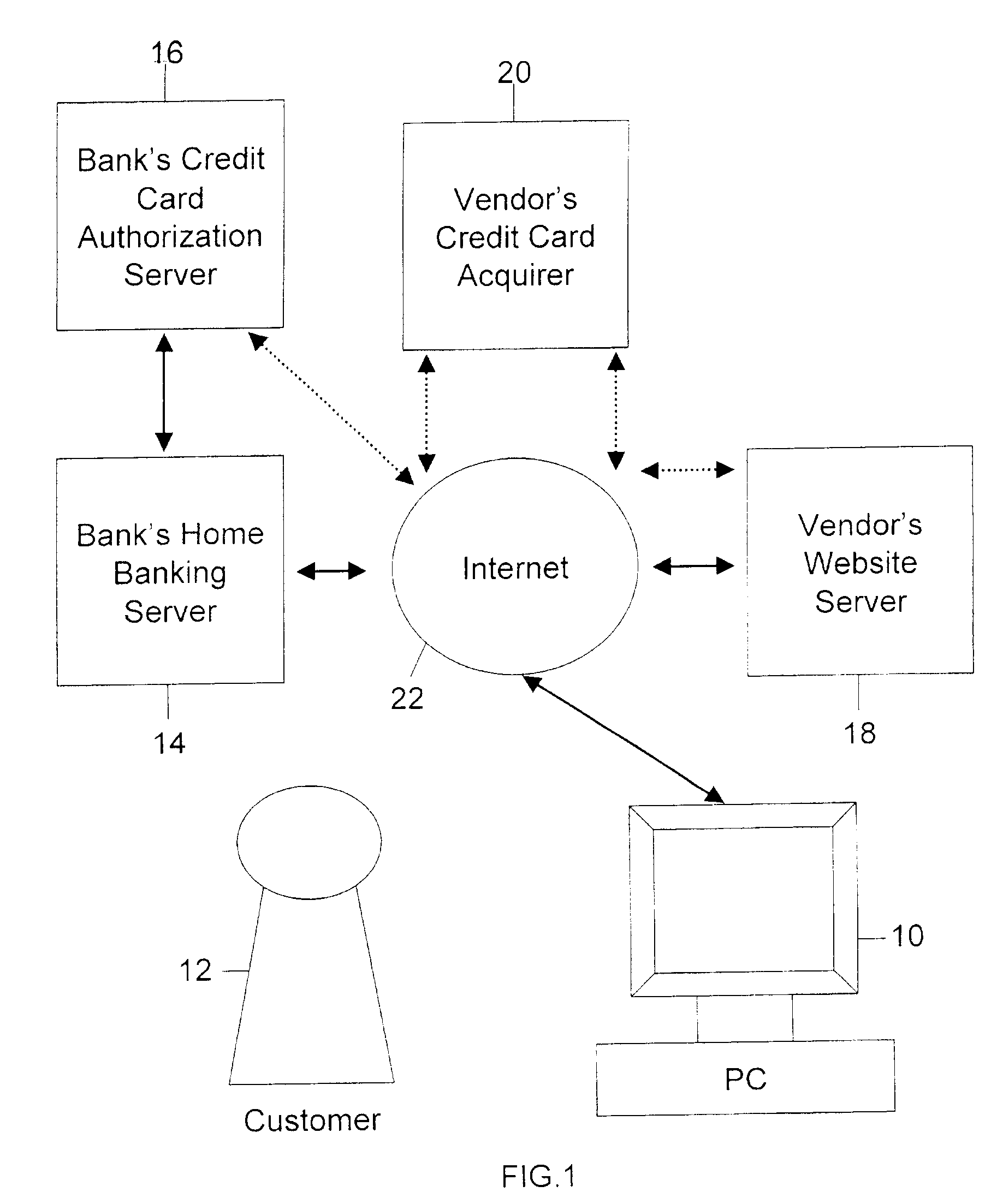

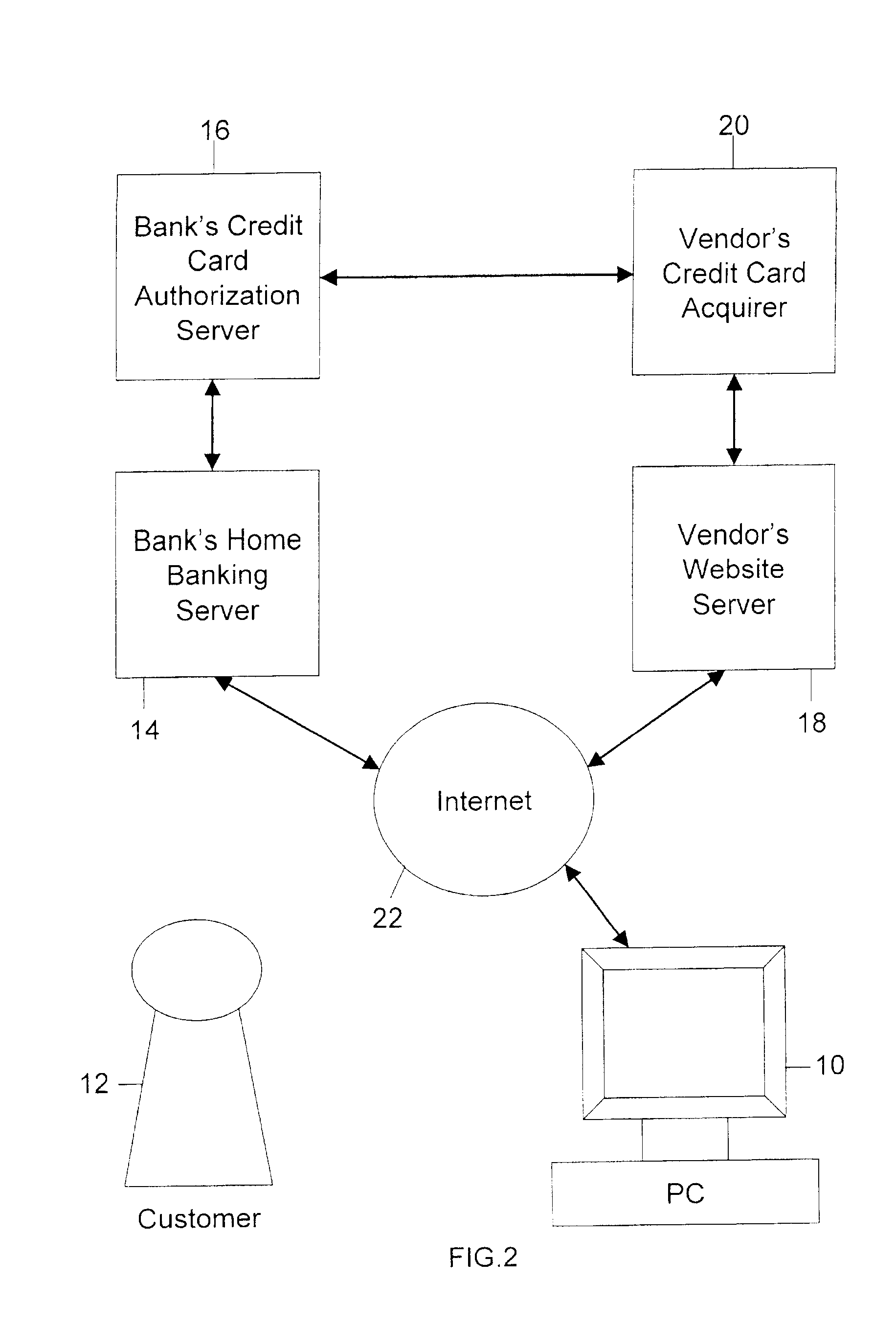

A system and method for performing an on-line transaction, such as making a payment, with a single-use payment instrument makes use of computer hardware and software, such as the computing device of a customer, the customer's bank's home banking server, the bank's card authorization server, a vendor's website server, and the vendor's credit card acquirer, coupled to one another over a network. The customer is issued a single use payment instrument through the bank, the bank debits an account nominated by the customer for the requested value of the payment instrument and may also specify an expiry for the payment instrument. The customer is able to nominate a particular source of funds for each transaction from among various accounts of the customer. The payment instrument settles and clears through existing credit card payment mechanisms without a need for special accommodation with the Internet vendor.

Owner:CITICORP CREDIT SERVICES INC (USA)

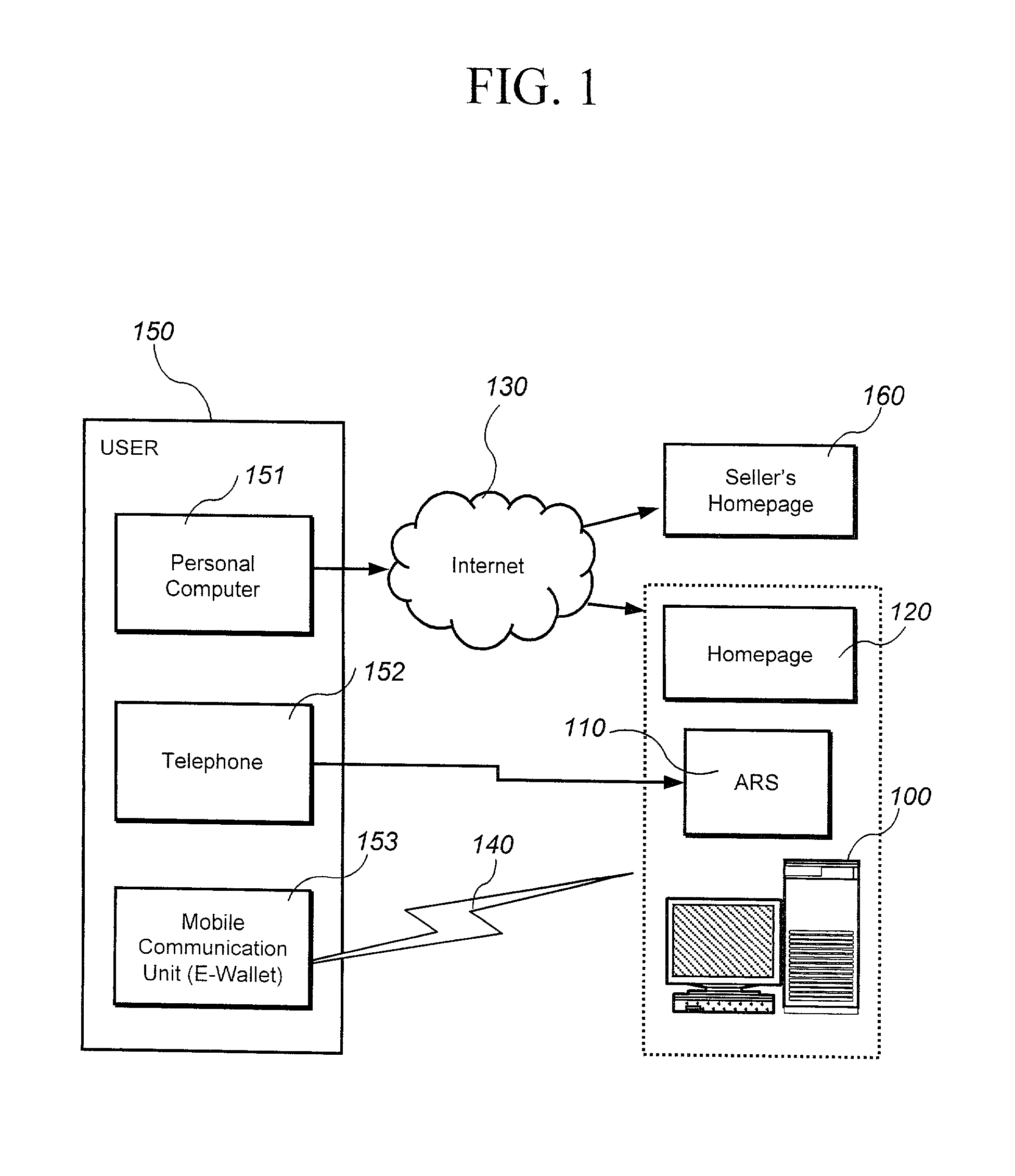

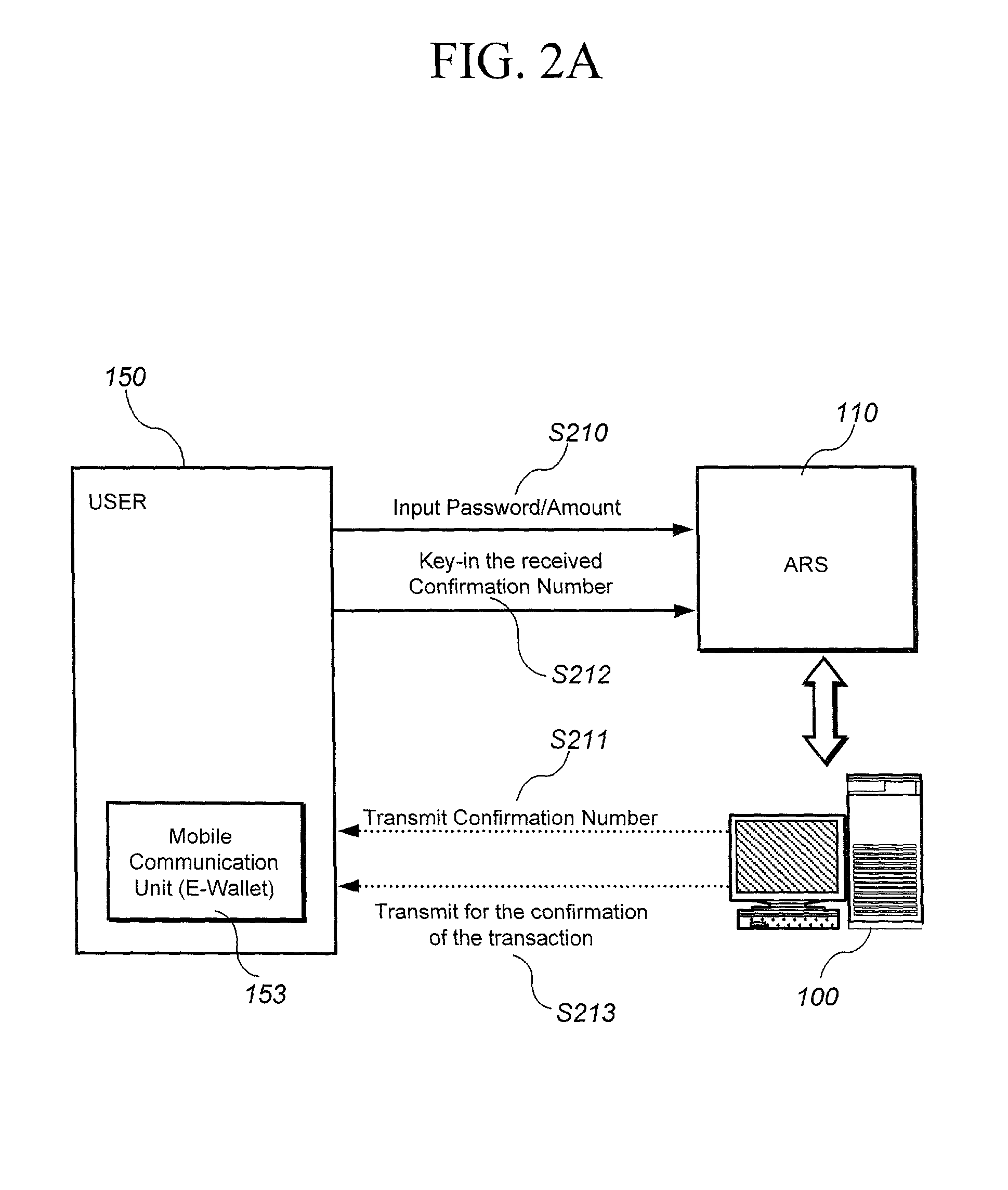

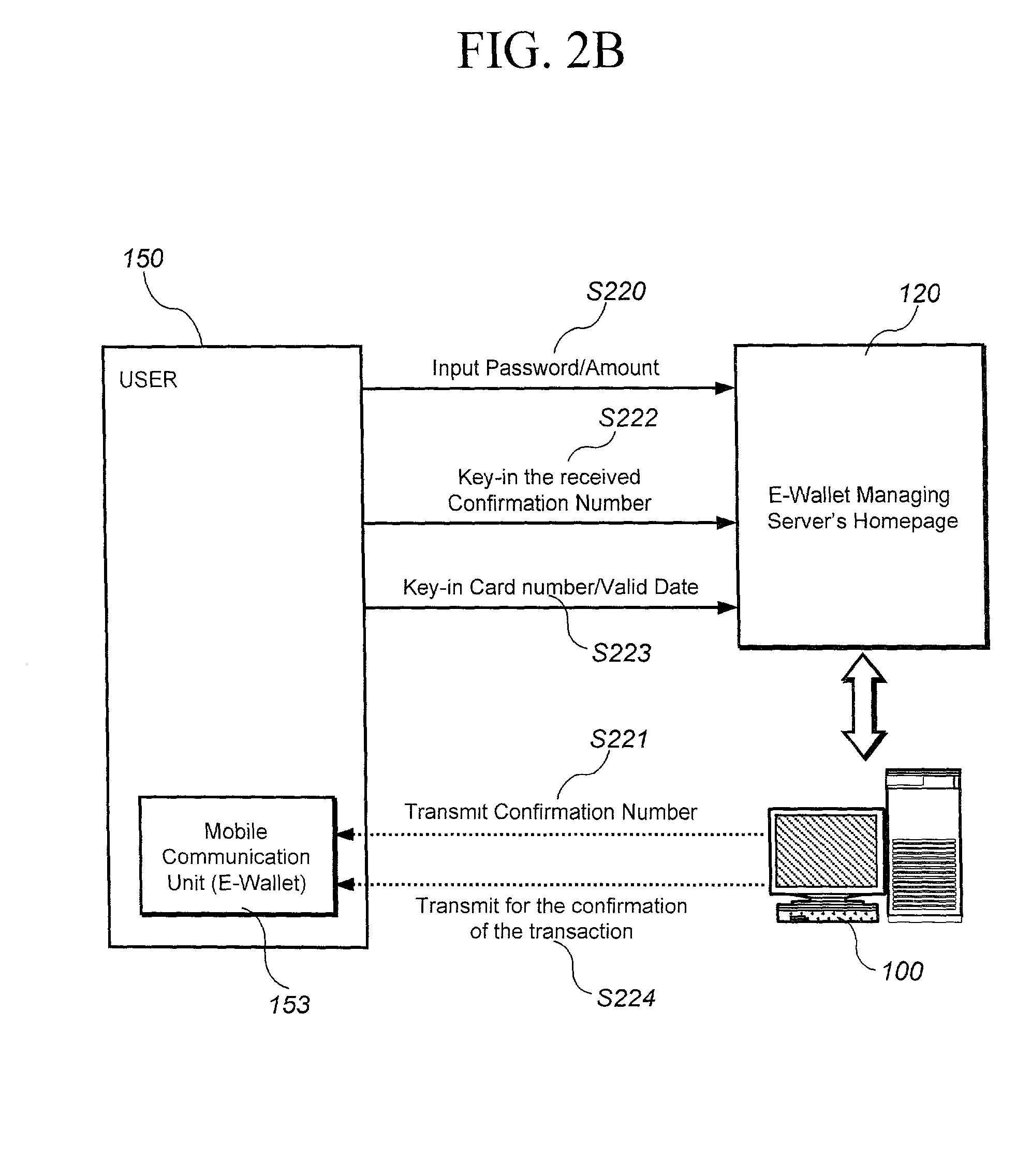

Method and system for transaction of electronic money with a mobile communication unit as an electronic wallet

InactiveUS20010007983A1Performed conveniently and safelyFinancePayment protocolsCommunication unitComputer science

A electronic monetary system comprising a mobile communication unit as an electronic wallet for transactions including electronic payments, money transfer, and recharging the electronic account. The security of the electronic transactions is confirmed by circulating a confirmation number through a loop formed by an E-wallet managing server through the wireless network to the mobile communication unit of the user.

Owner:INFOHUB

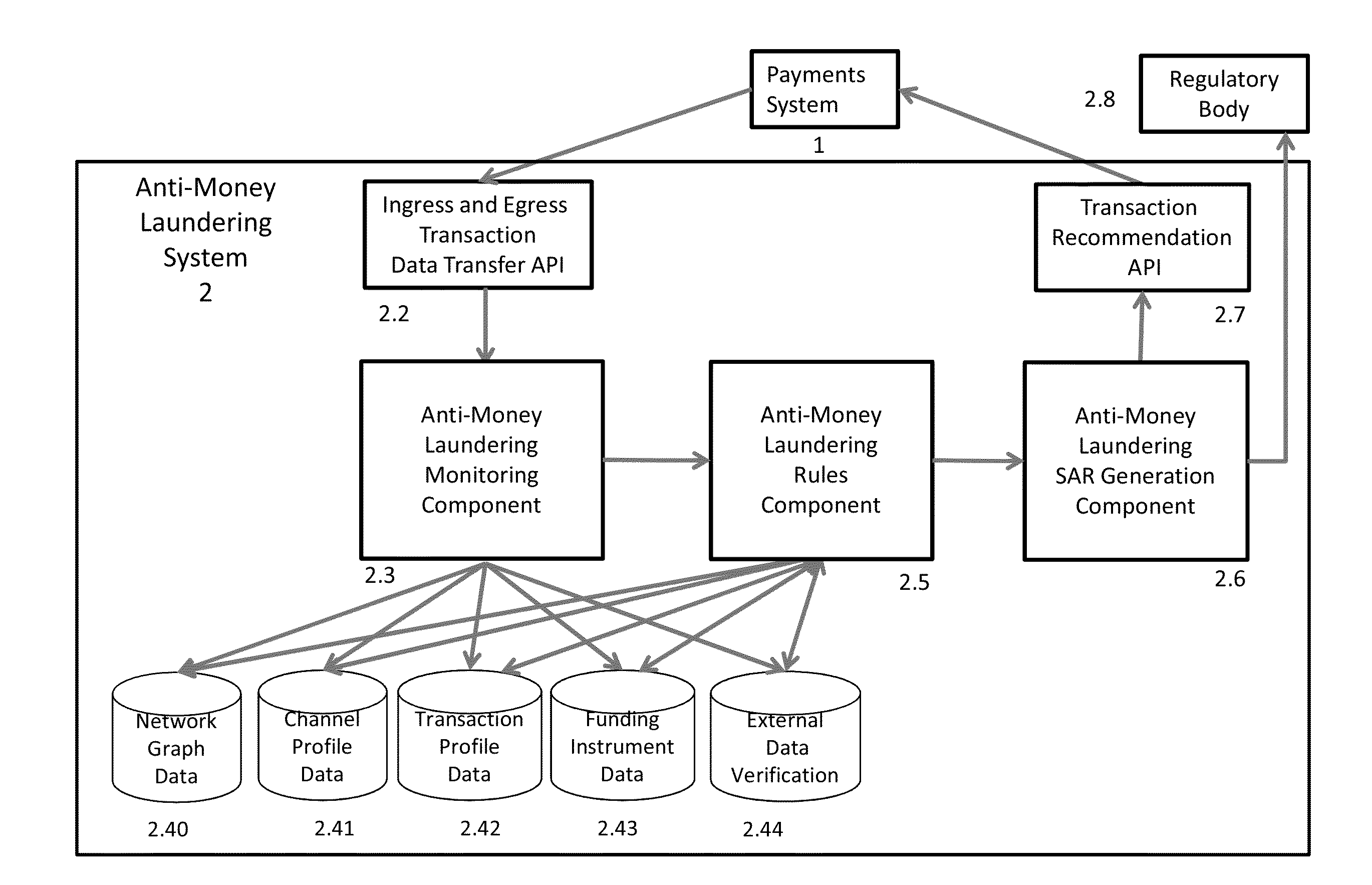

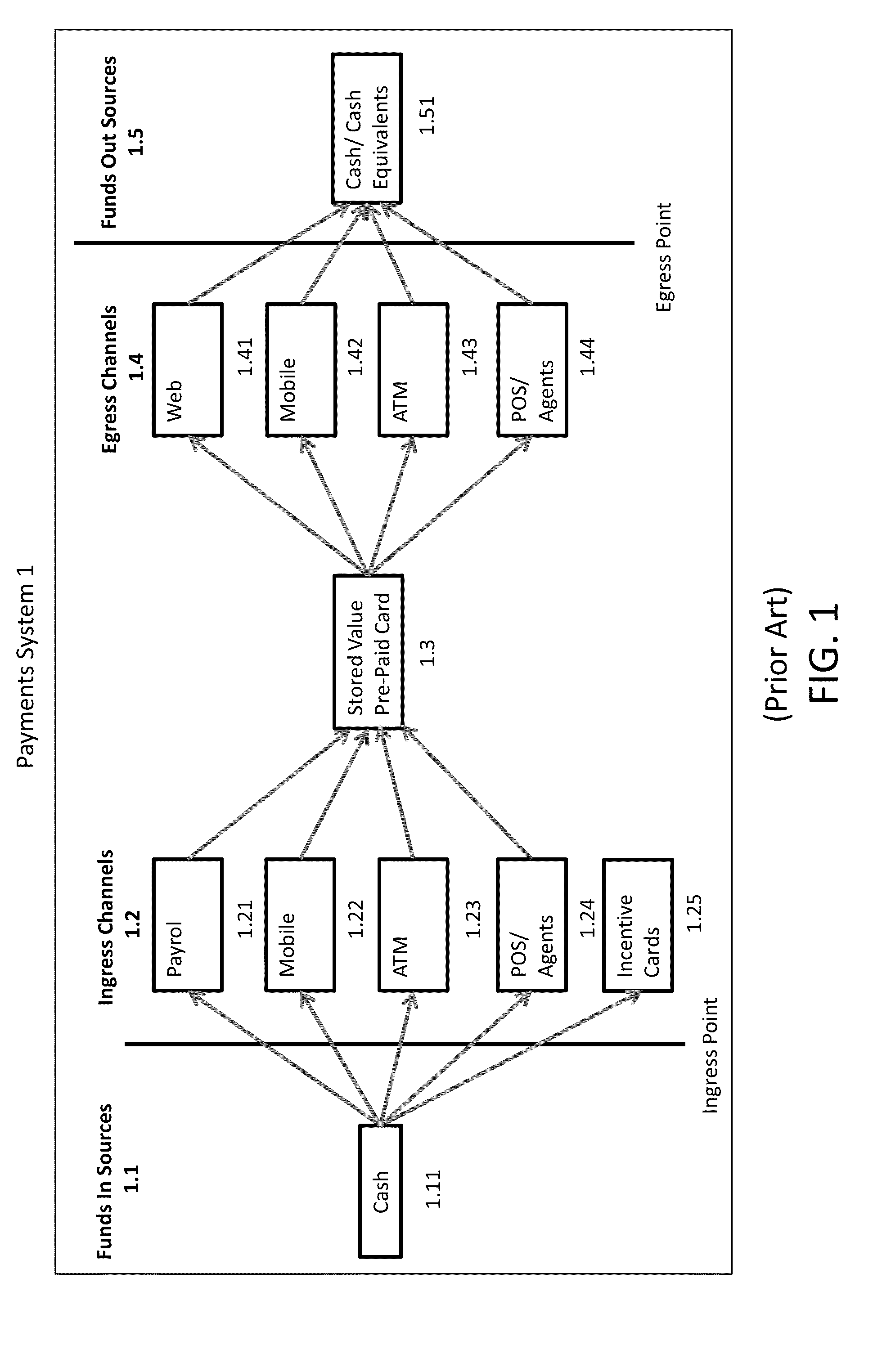

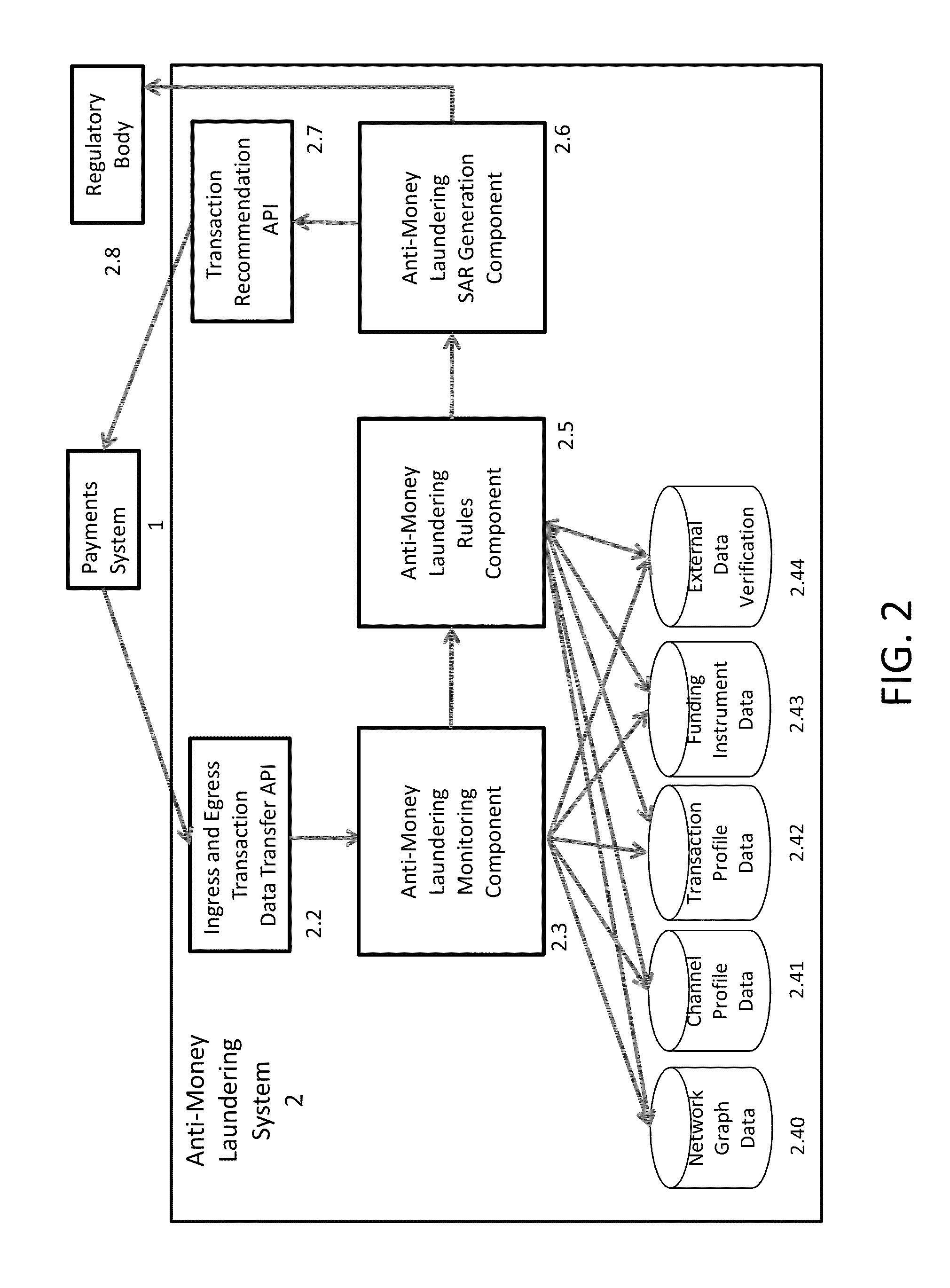

Multi-Channel Data Driven, Real-Time Anti-Money Laundering System For Electronic Payment Cards

Electronic payment card money laundering detection includes receiving real-time payment card transaction data from ingress channels and an egress channels of at least one payment card system through a first API; generating transactional profiles for each of at least payment cards, the ingress channel, the egress channels, and funding sources of the payment cards; in response to receiving transaction data for a current payment card transaction, evaluating the transaction data using a predictive algorithm that compares the transaction data to the transactional profiles to calculate a probabilistic money laundering score for the current transaction; evaluating the probabilistic money laundering score and current transaction data based on a set of rules to generate a suspicious activity report that recommends whether to approve or report the current transaction; and transmitting the suspicious activity report back to the payment card system and transmitting the suspicious activity report to an identified regulatory body.

Owner:WALMART APOLLO LLC

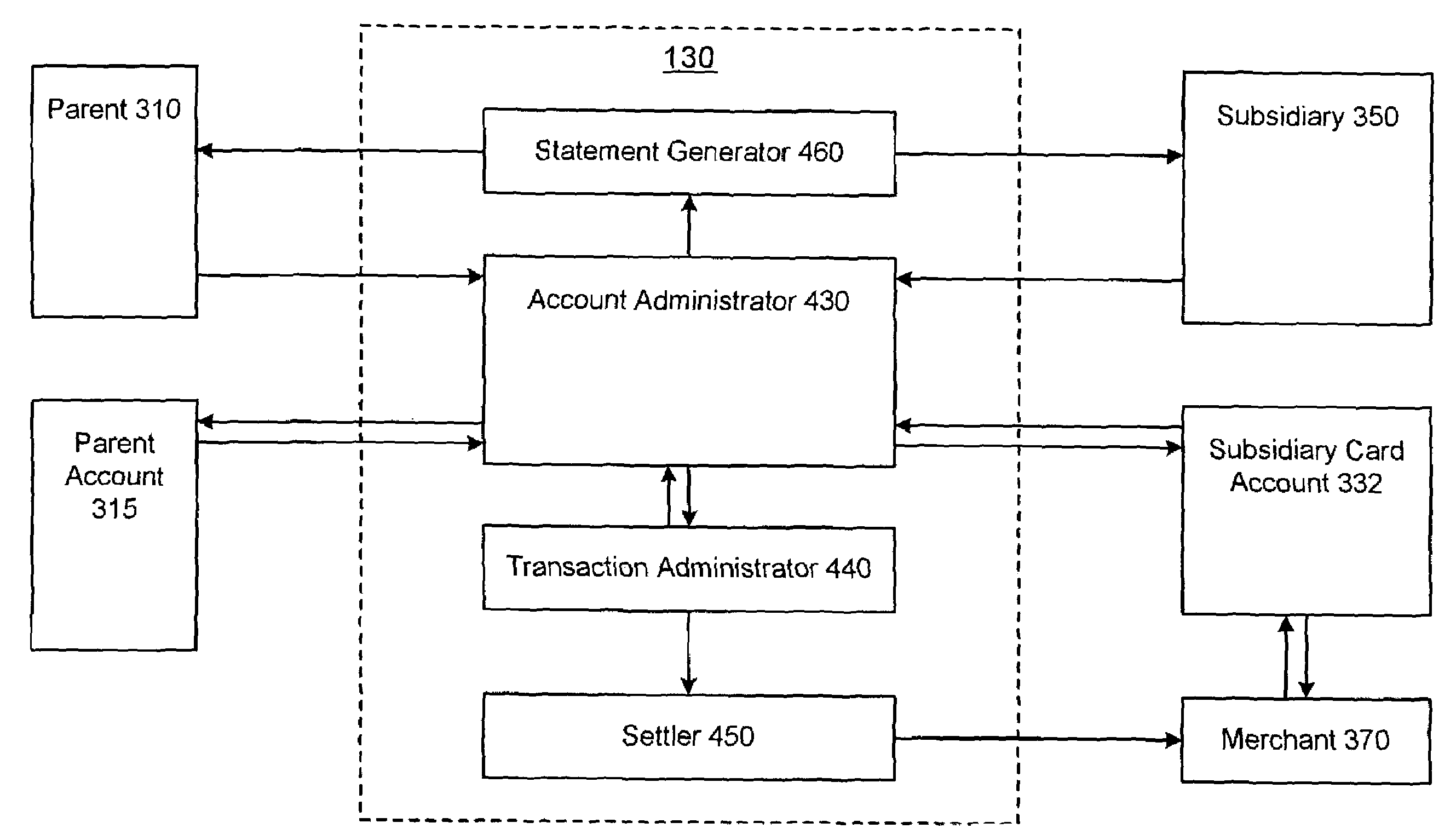

System and method for facilitating a subsidiary card account with controlled spending capability

InactiveUS7249092B2Reduce capacityFacilitate establishmentComplete banking machinesFinanceEngineeringCommunication device

The present invention provides a system and method for facilitating a subsidiary account with parental control of one or more spending limits. An exemplary system facilitates the provisioning of funds to a subsidiary account and the control of the spending of the subsidiary account by a parent through establishment or modification of one or more spending limits through various communication devices. Exemplary spending limits may be configured for modifying a spending capacity so as to affect an amount per transaction, per day, during a predetermined time period, at a particular merchant, at a particular chain of merchants, at a type of industry, in accordance with a predetermined rate of increase or decrease over time, number of transactions during any time period and / or any combination thereof.

Owner:LIBERTY PEAK VENTURES LLC

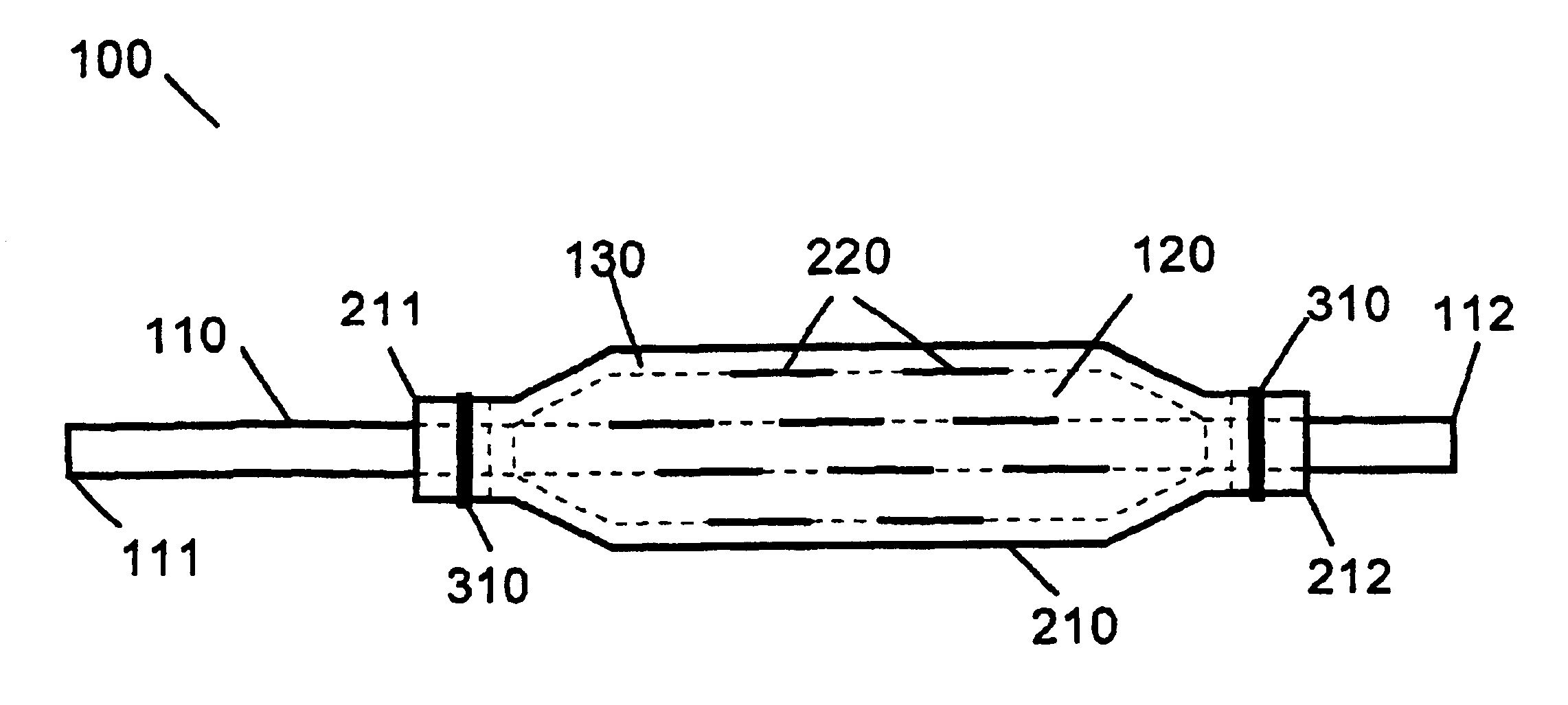

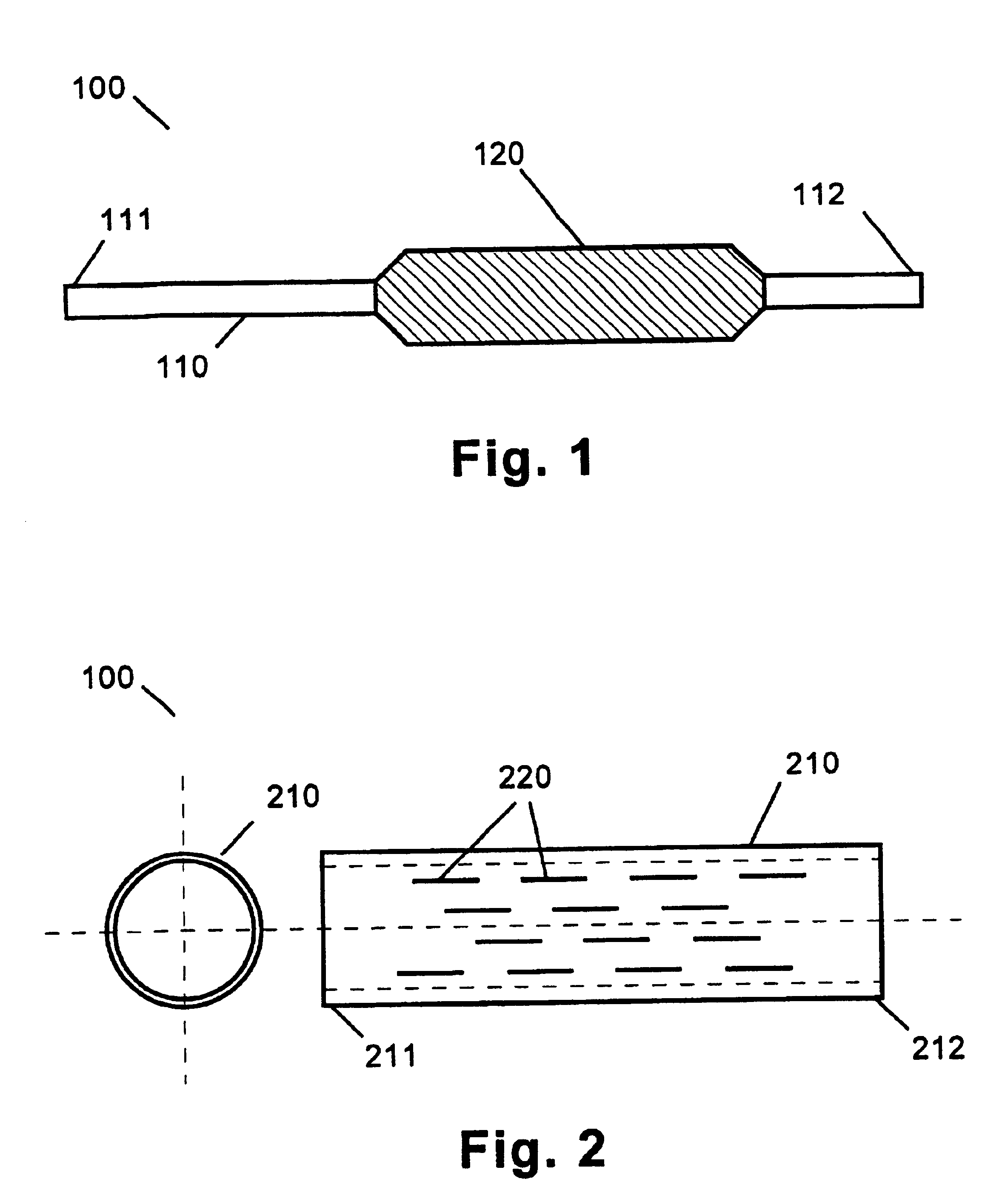

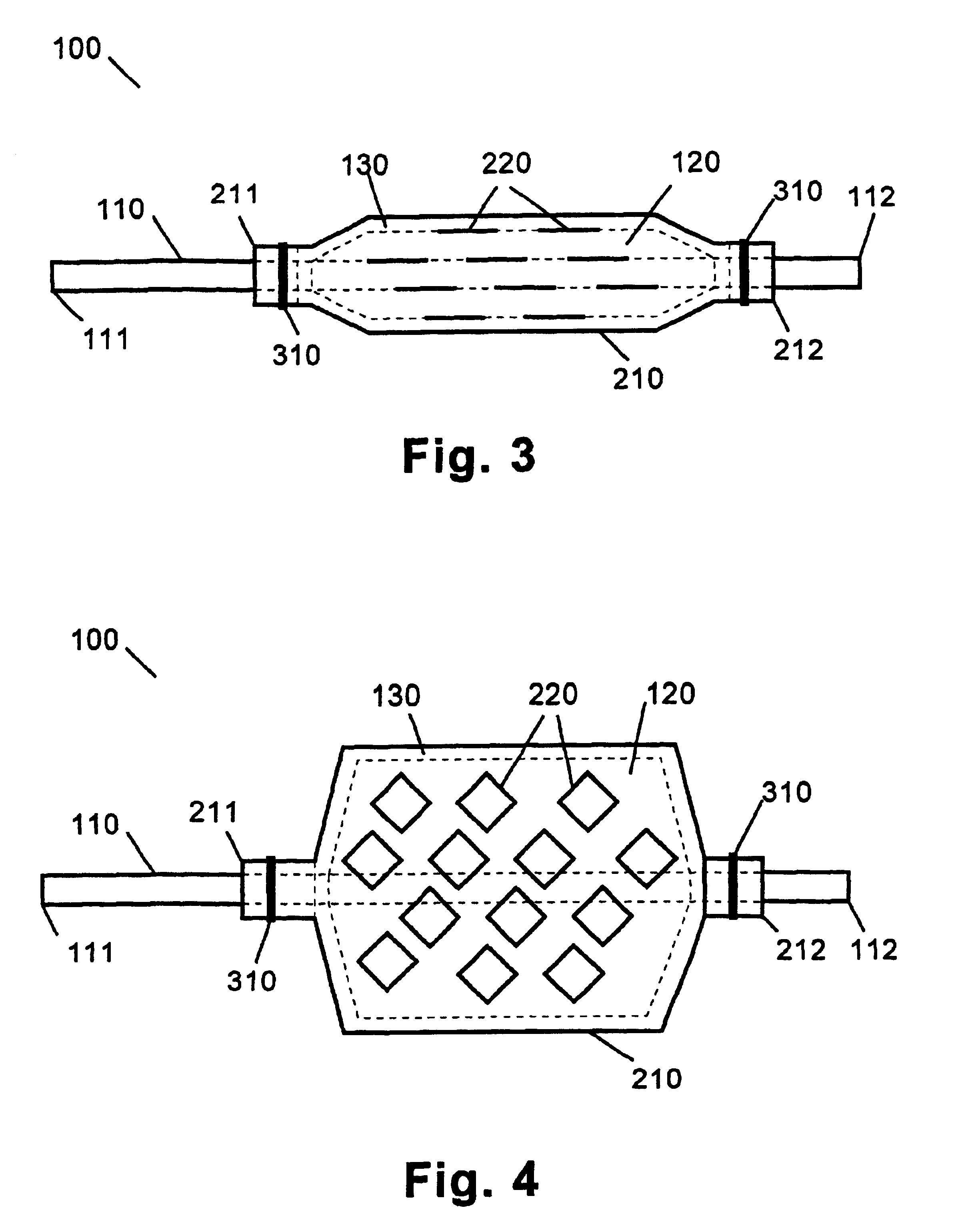

Localized delivery of drug agents

Medical devices including a substrate that are expandable from a compressed state to an expanded state; a coating on the substrate, the coating having a drug agent incorporated therein; and a sheath over the coating. The sheath is expandable from a compressed state to an expanded state and has at least one perforation therein. The medical devices are configured such that when the substrate is in a compressed state, the sheath is also in a compressed state and the perforation is substantially closed. When the substrate is in an expanded state, the sheath is also in an expanded state and the perforation is substantially open. The invention also includes a method of using the medical devices for the controlled, localized delivery of a drug agent to a target location within a mammalian body.

Owner:BOSTON SCI SCIMED INC

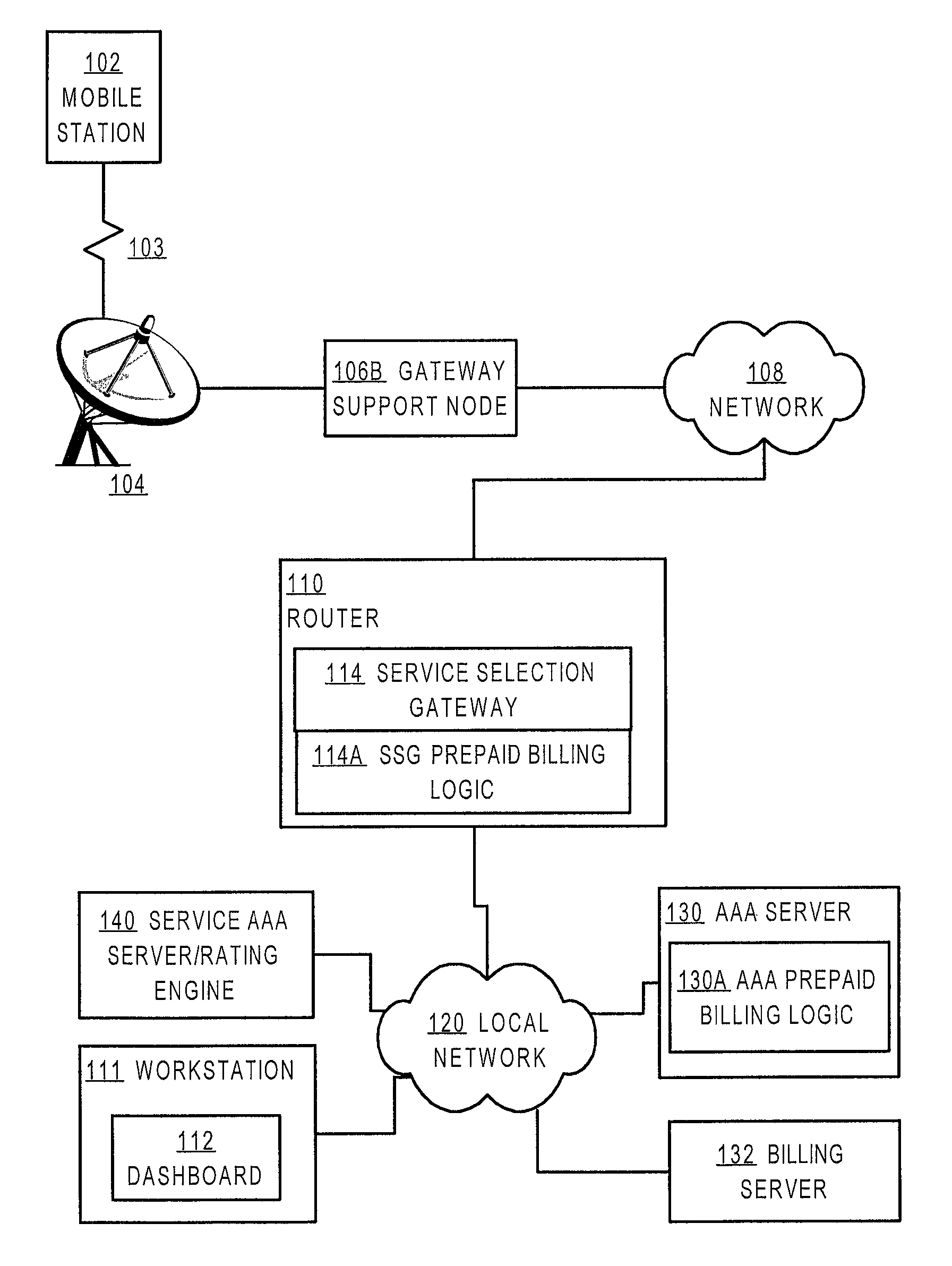

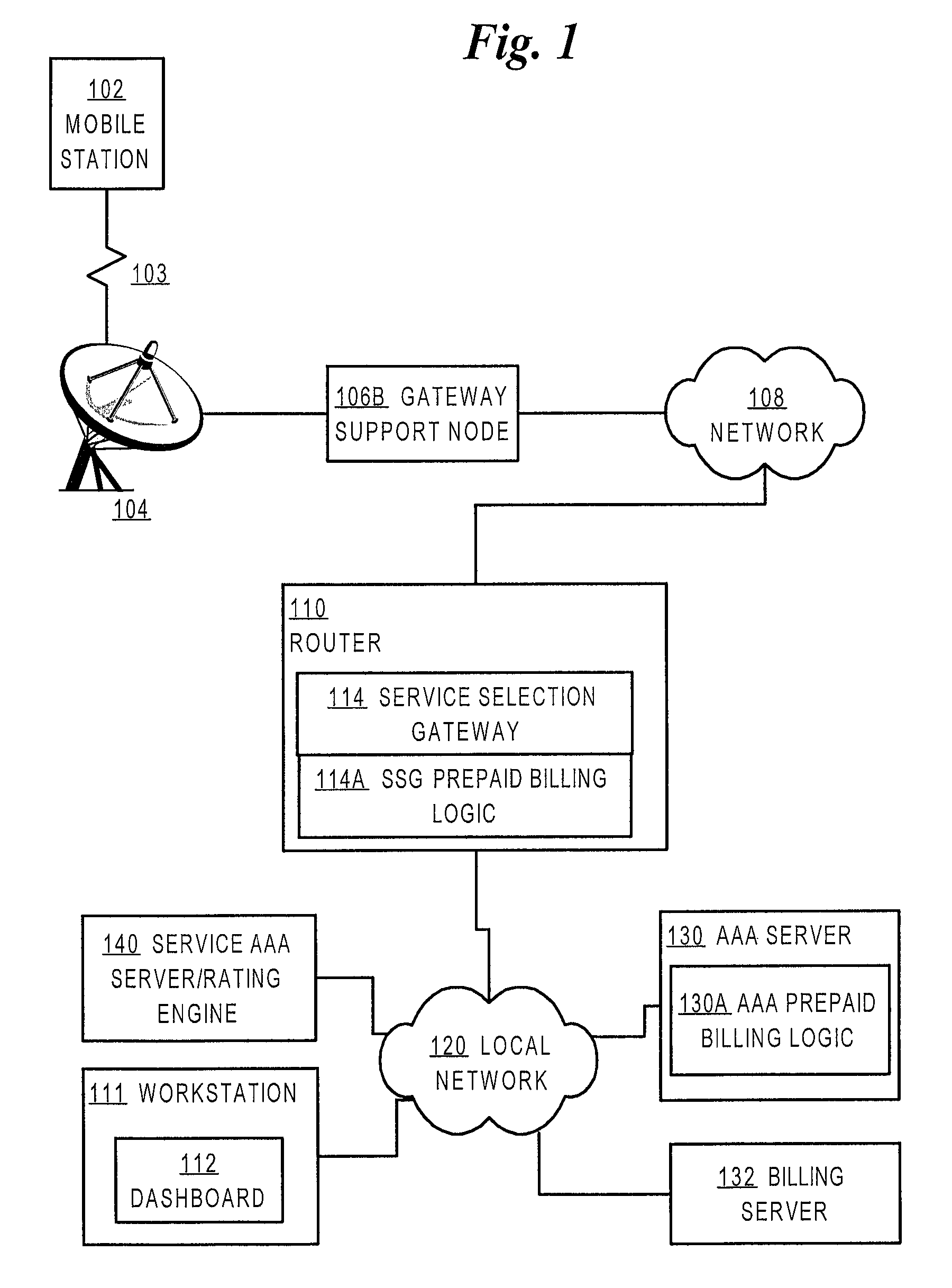

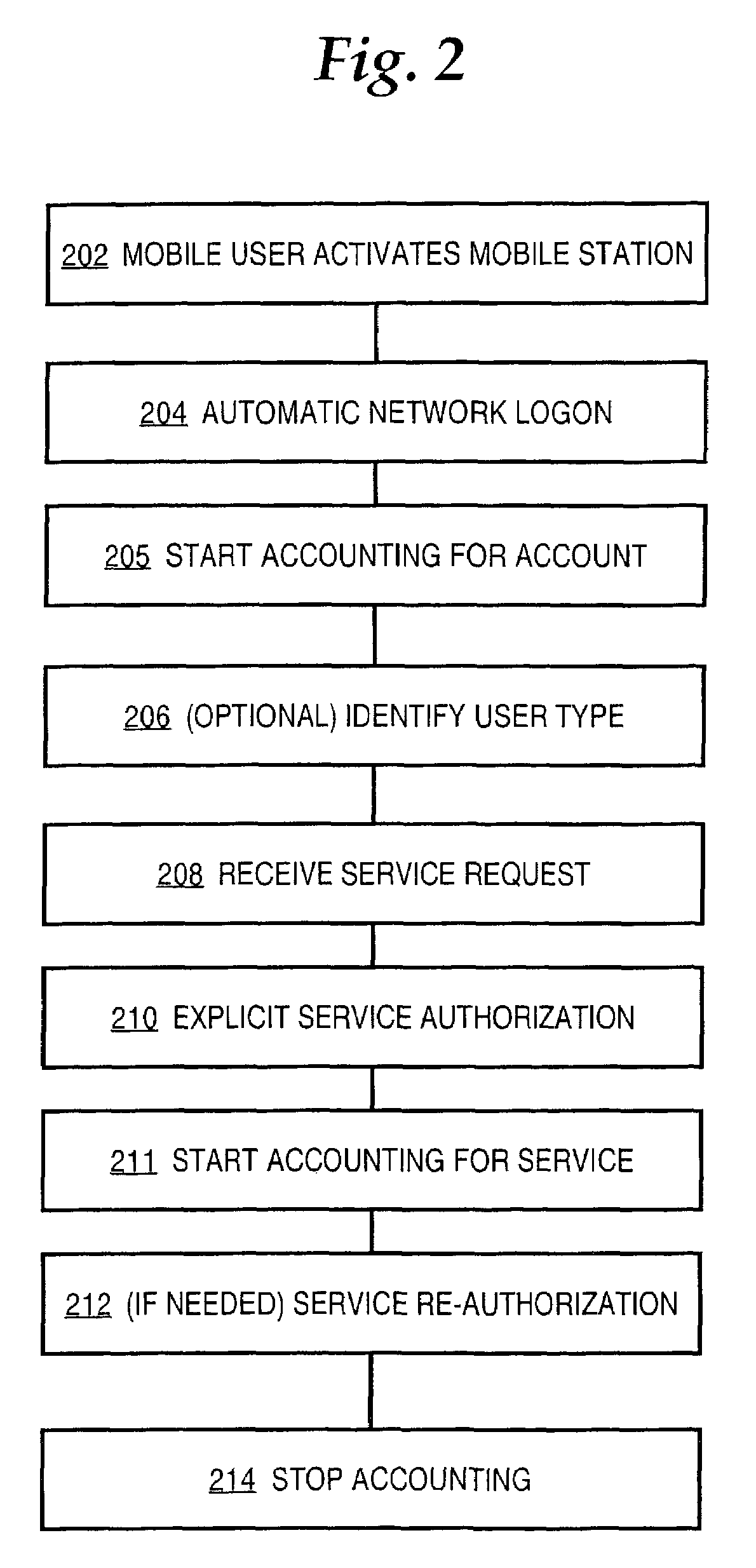

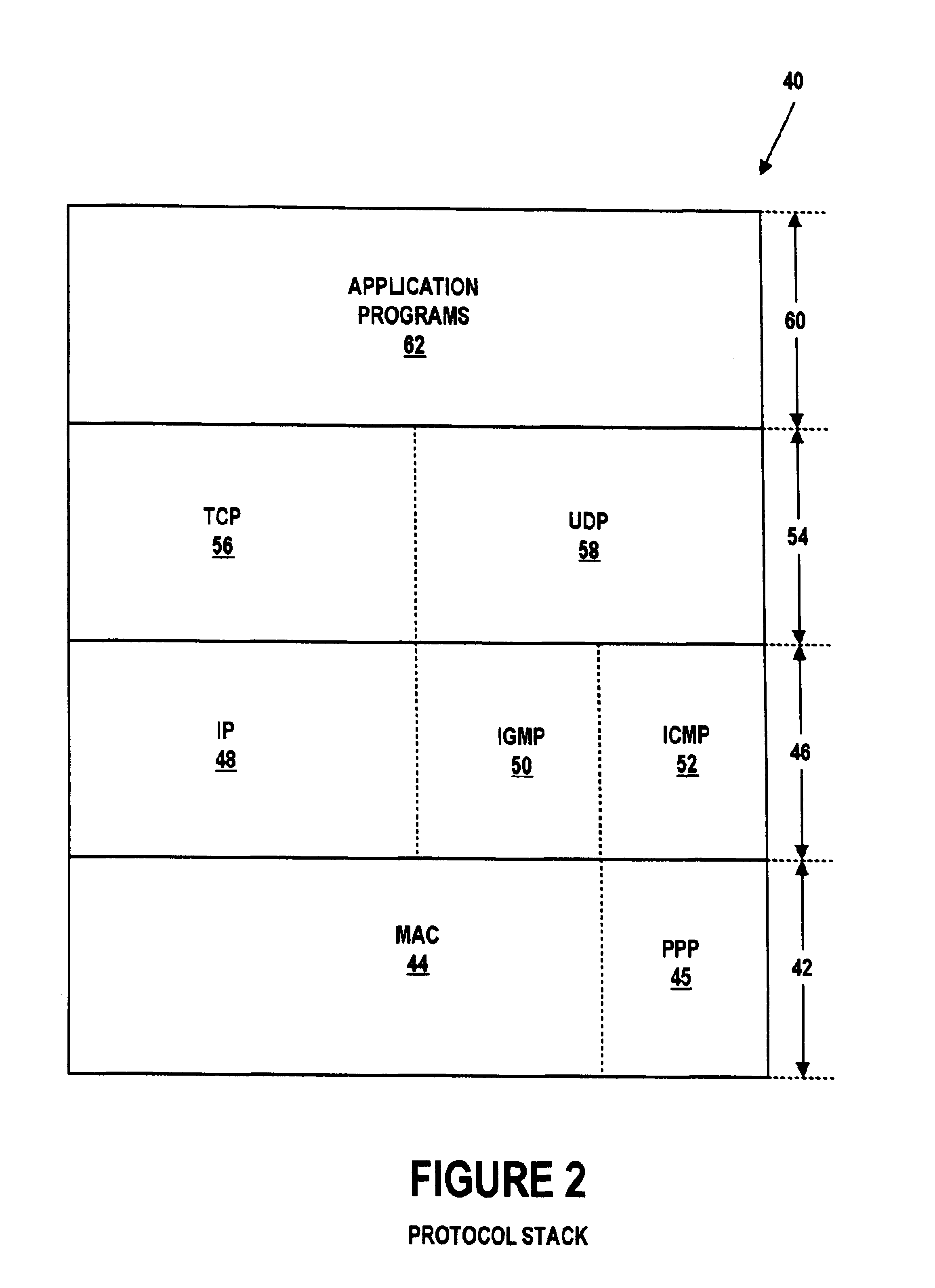

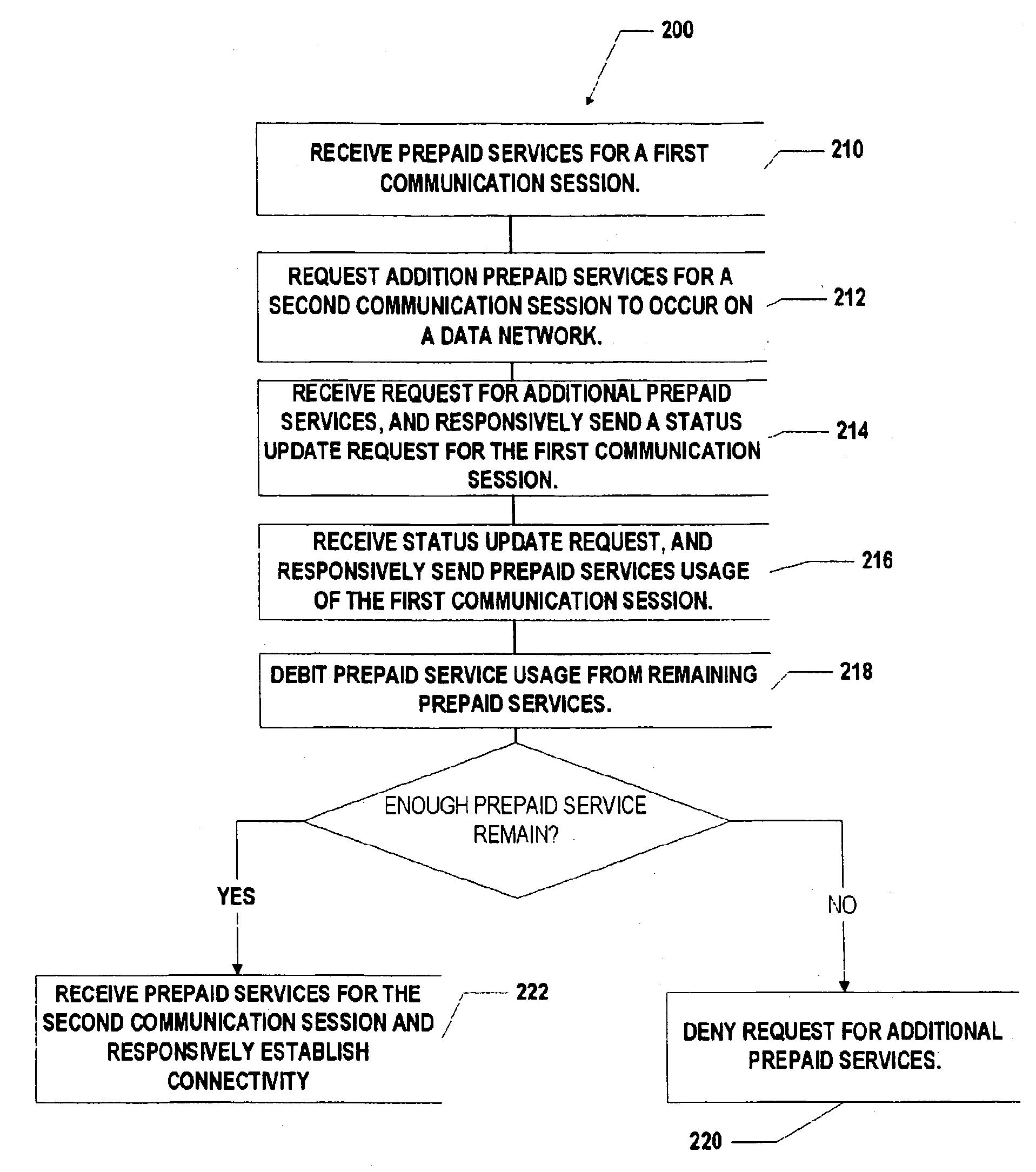

Method and apparatus providing prepaid billing for network services using explicit service authorization in an access server

ActiveUS7720960B2Complete banking machinesAccounting/billing servicesNetwork terminationTraffic capacity

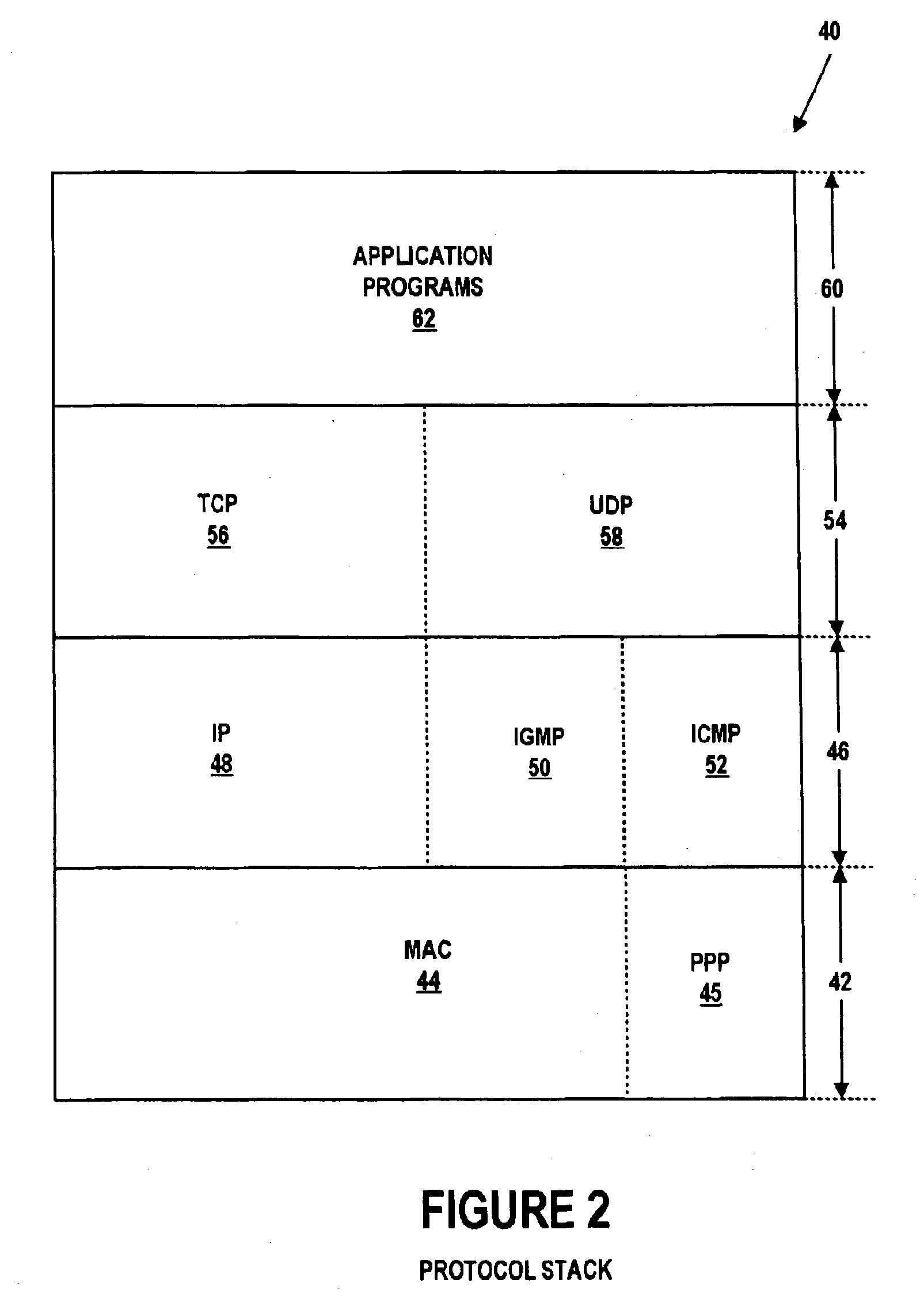

A method is disclosed for authorizing a prepaid network service in a data network. A network end station issues a request for a prepaid network service. At a network node, such as a router serving as a gateway for selecting services, a determination is made about whether a user associated with the end station is authorized to access the prepaid network service. Network traffic from the end station is forwarded to a service provider only when the user is authorized to use the prepaid network service. Specific embodiments provide message flows among a mobile station, gateway support node, router, and authentication server that support providing prepaid services in a packet-switched network for mobile communication. In certain embodiments, a connection is held open for an end station while a prepaid quota value is refreshed at a portal, thereby reducing overhead and precluding the need to repeat user logon steps. Further, unused quota amounts can be returned to the authentication server for use in association with multiple concurrent connections of the same device.

Owner:CISCO TECH INC

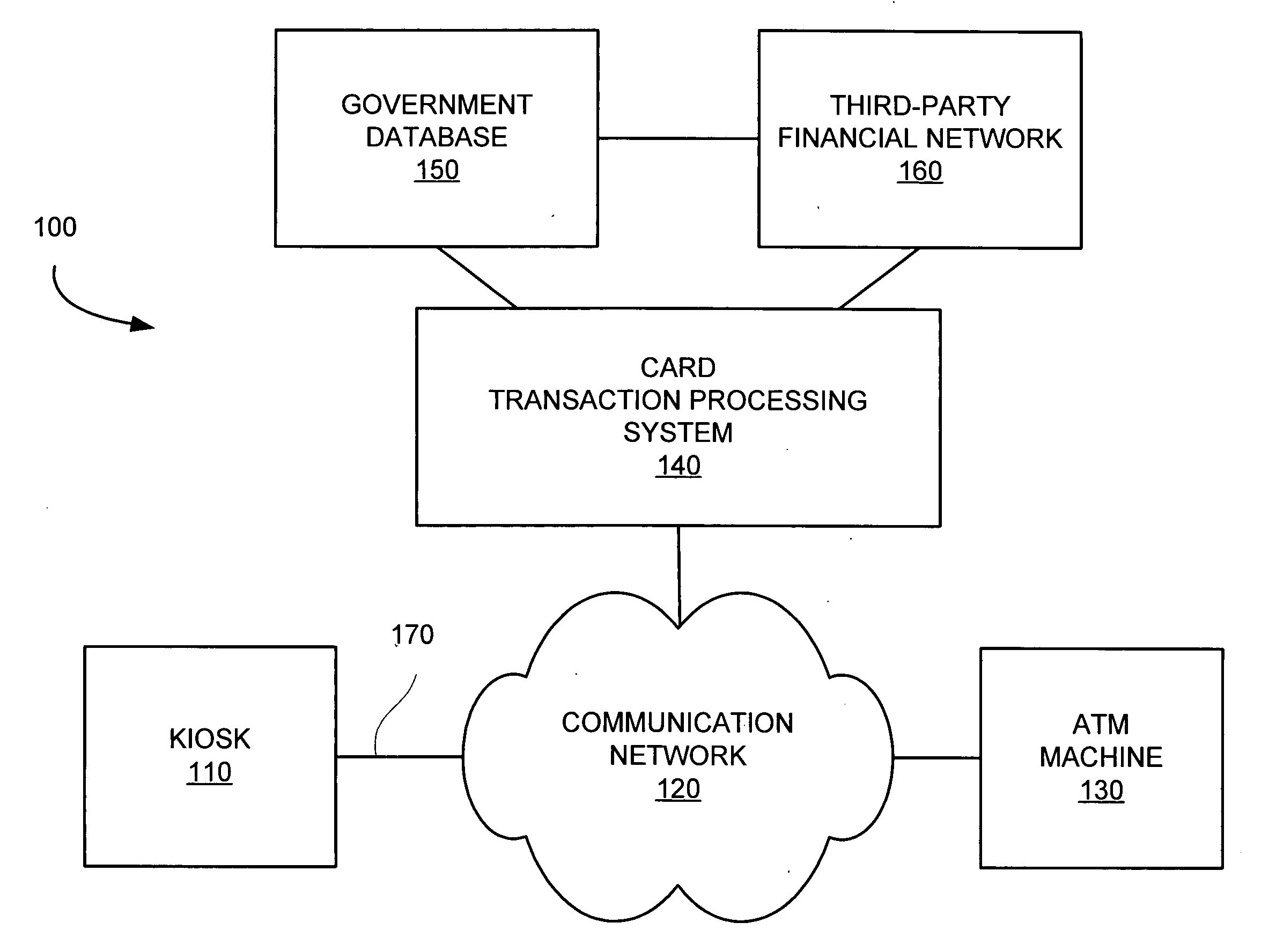

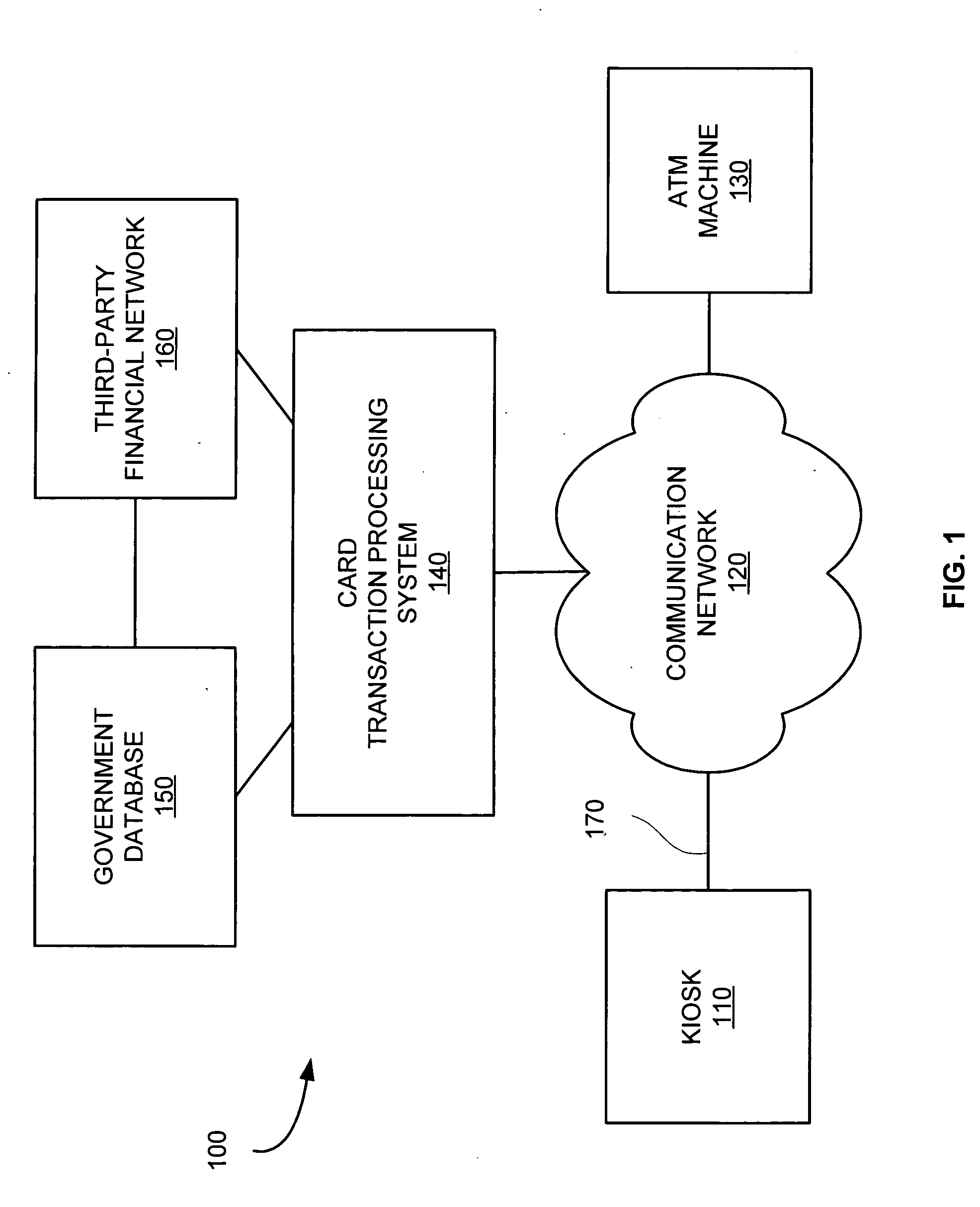

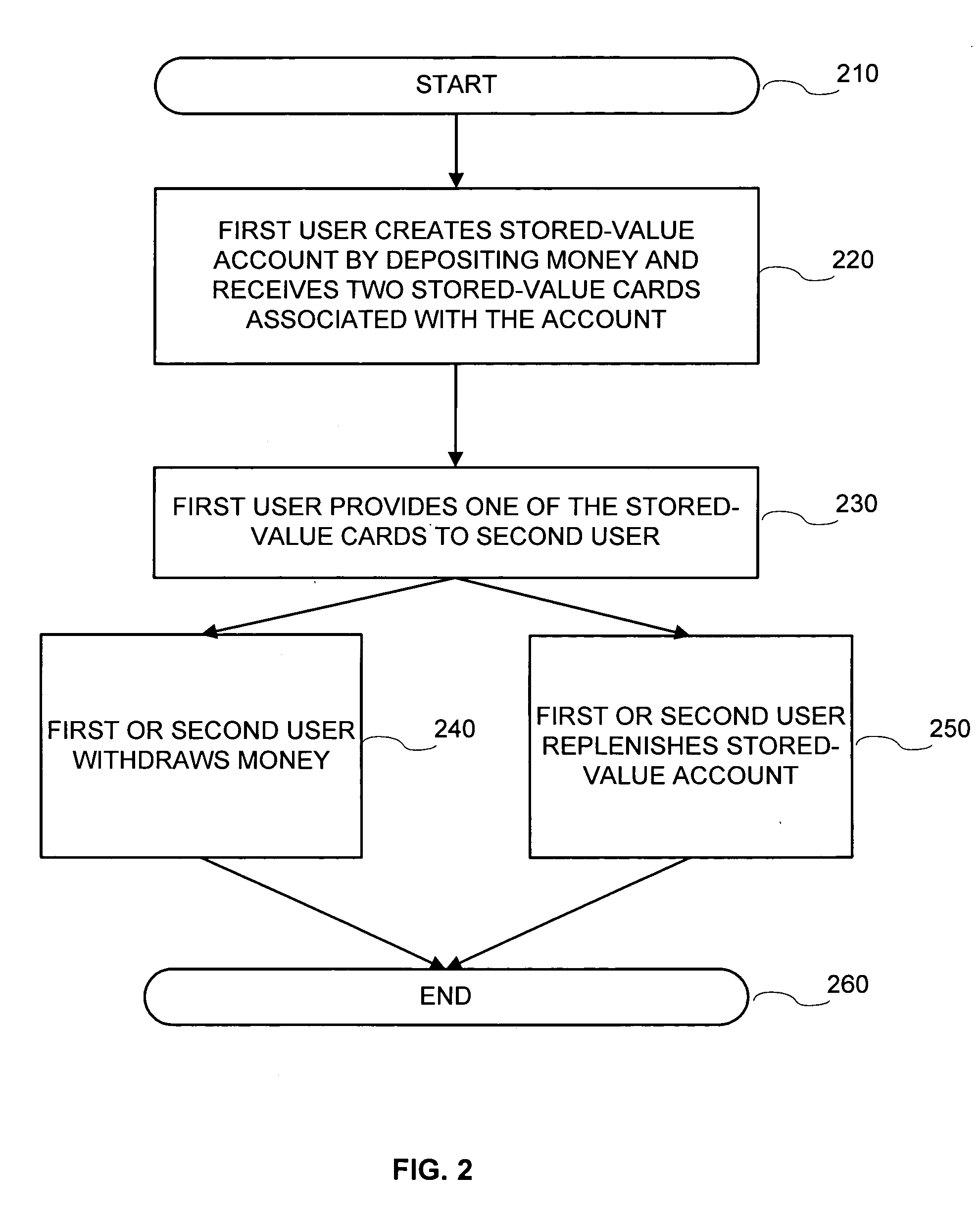

Systems and methods for money sharing

A system and a method for money sharing are provided. The system includes a processor configured to receive a deposit amount and assign an account value to a stored-value account. The stored-value account is stored in a storage device. The processor then dispenses two or more stored-value cards associated with the stored-value account. The stored-value cards can be distributed among two or more cardholders who may withdraw money from the stored-value account at a remote access unit configured to accept any of the distributed stored-value cards associated with the same account. Additional deposit amount can be received into the stored-value account from a cardholder of any distributed stored-value cards associated with the same account. The remote access unit can be unattended. The cards can be ATM-enabled.

Owner:MONEYGRAM PAYMENT SYST

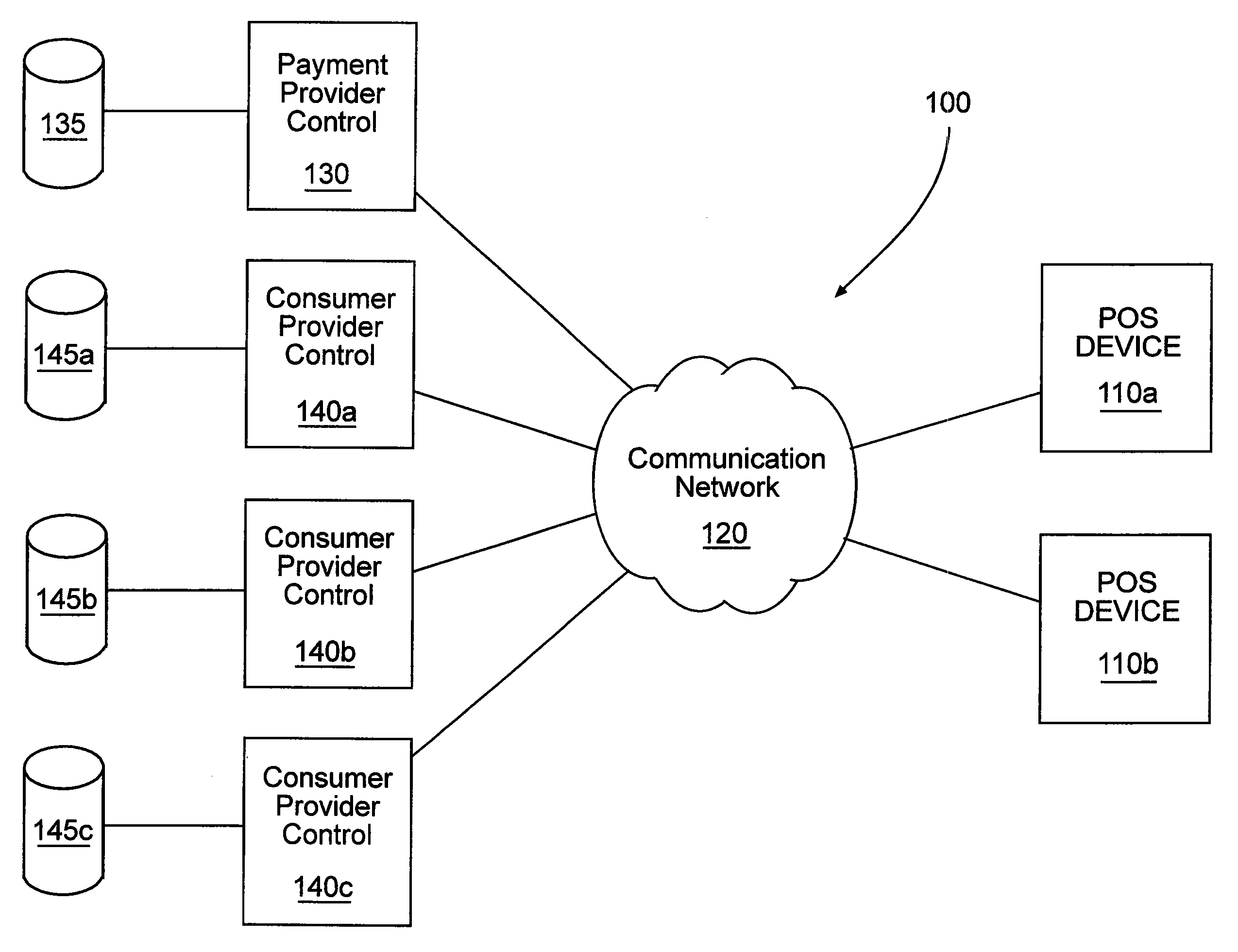

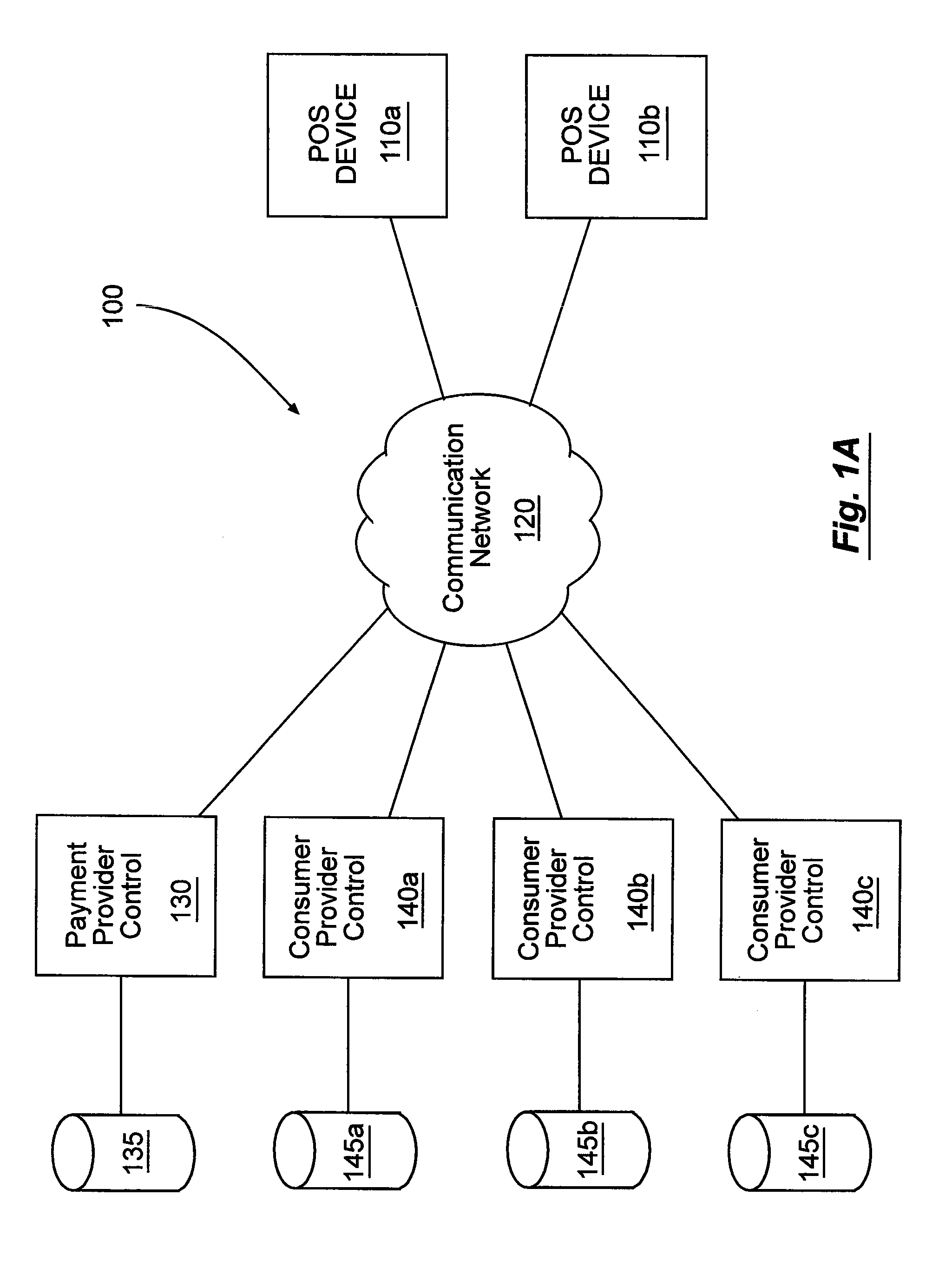

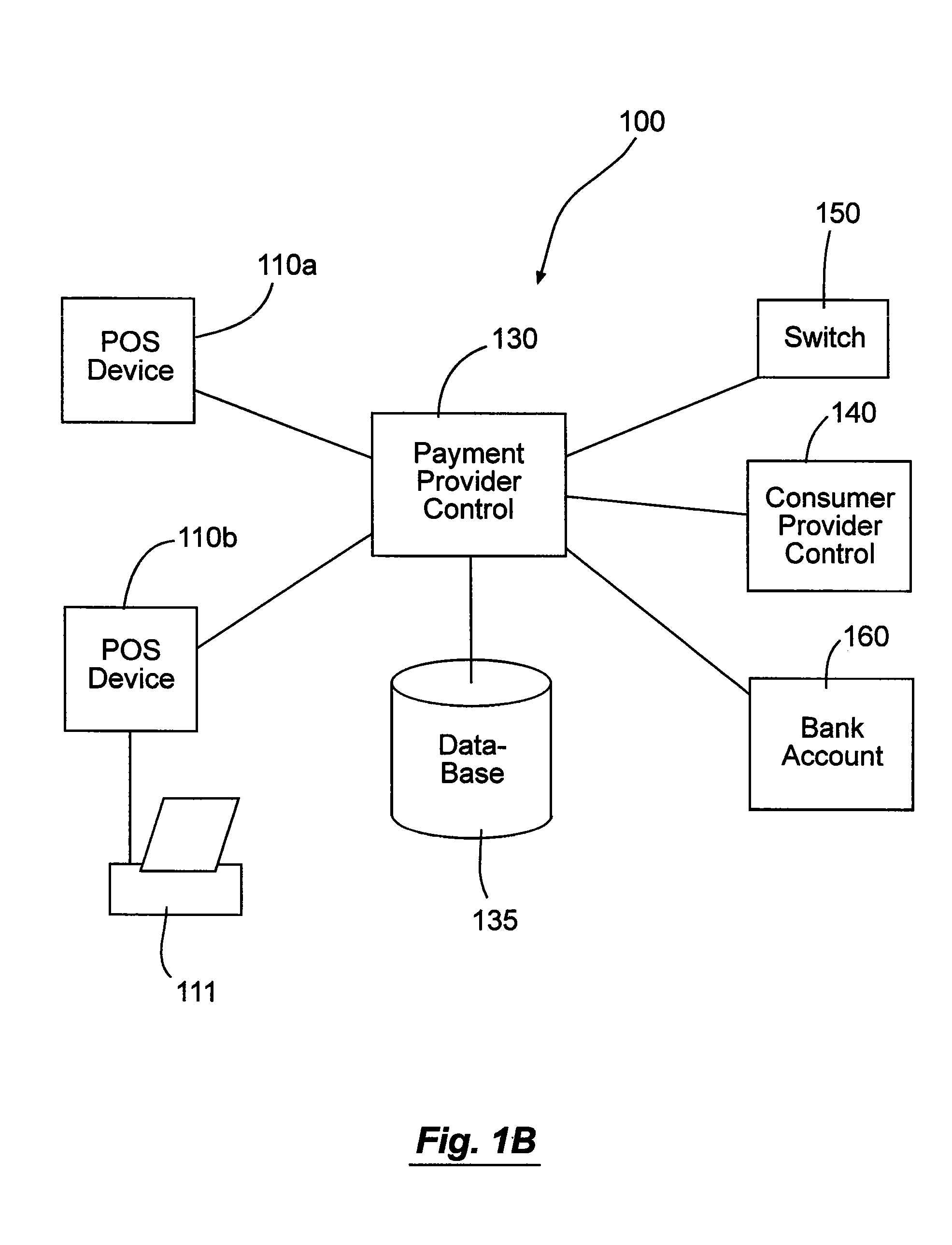

Electronic identifier payment systems and methods

InactiveUS7107249B2Optimize locationCredit registering devices actuationDiscounts/incentivesPaymentElectronic identification

Systems and methods for accepting payments for goods and services provided by a consumer provider. The methods can include associating consumers and consumer providers with a payment provider. The payment provider can receive payments destined for the consumer provider, associate the payments with one or more identifiers, and transfer at least portions of the receive payments to the consumer provider. The systems can include a point-of-sale device configured to accept payments from consumers on behalf of consumer providers. In some cases, the systems include a plurality of such point-of-sale devices in communication with a payment provider control. The payment provider control can be in communication with one or more consumer provider controls.

Owner:THE WESTERN UNION CO

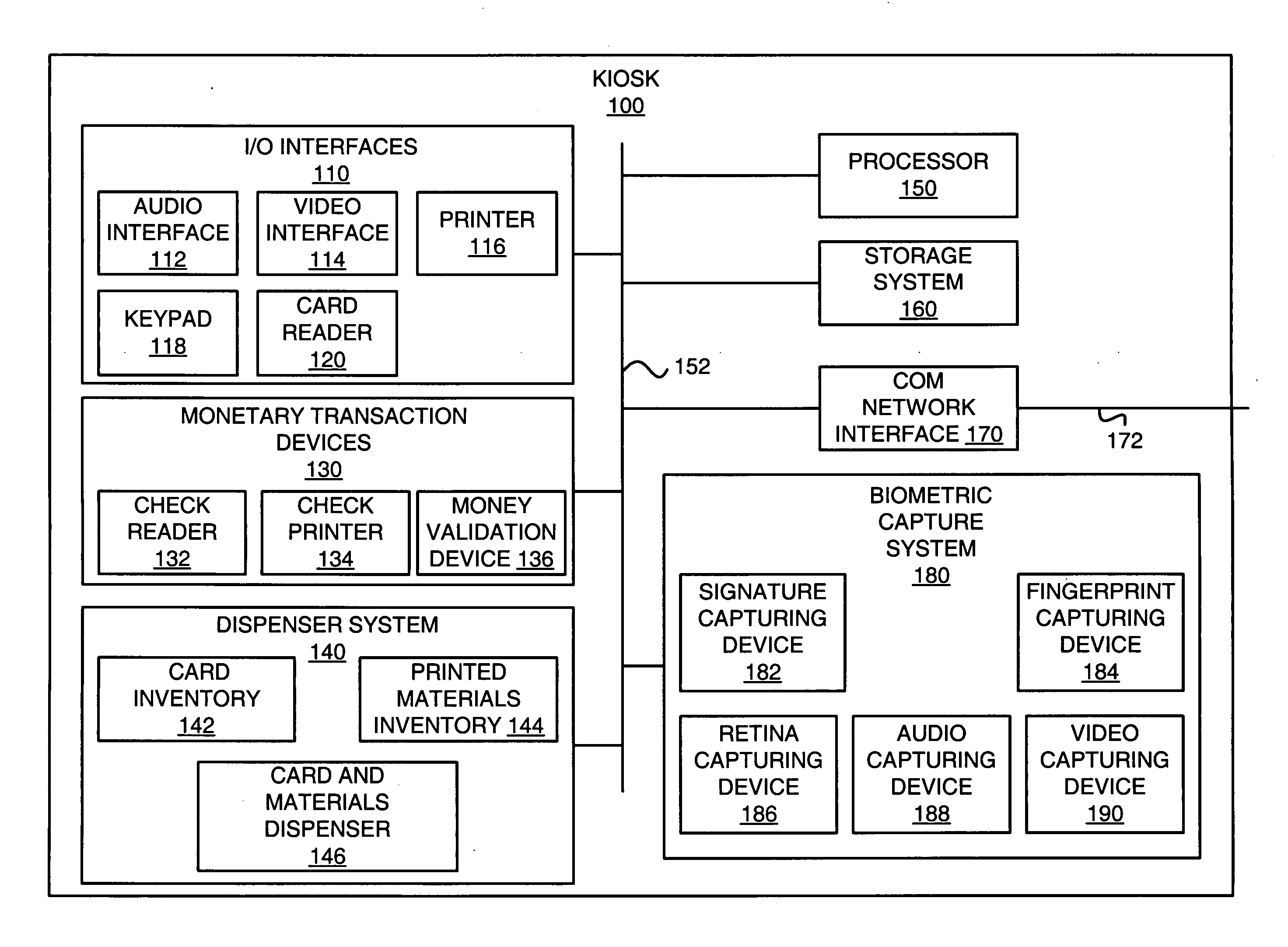

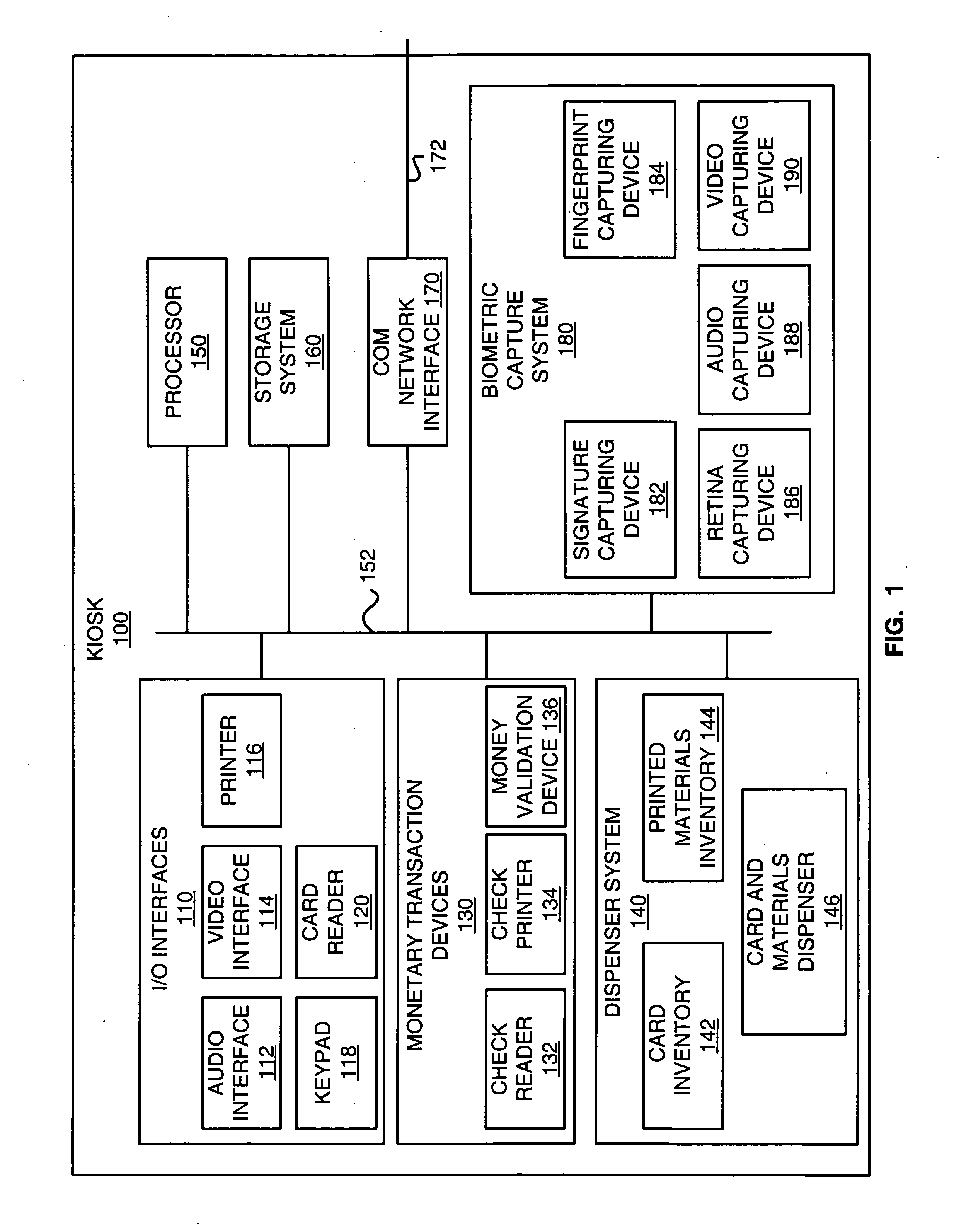

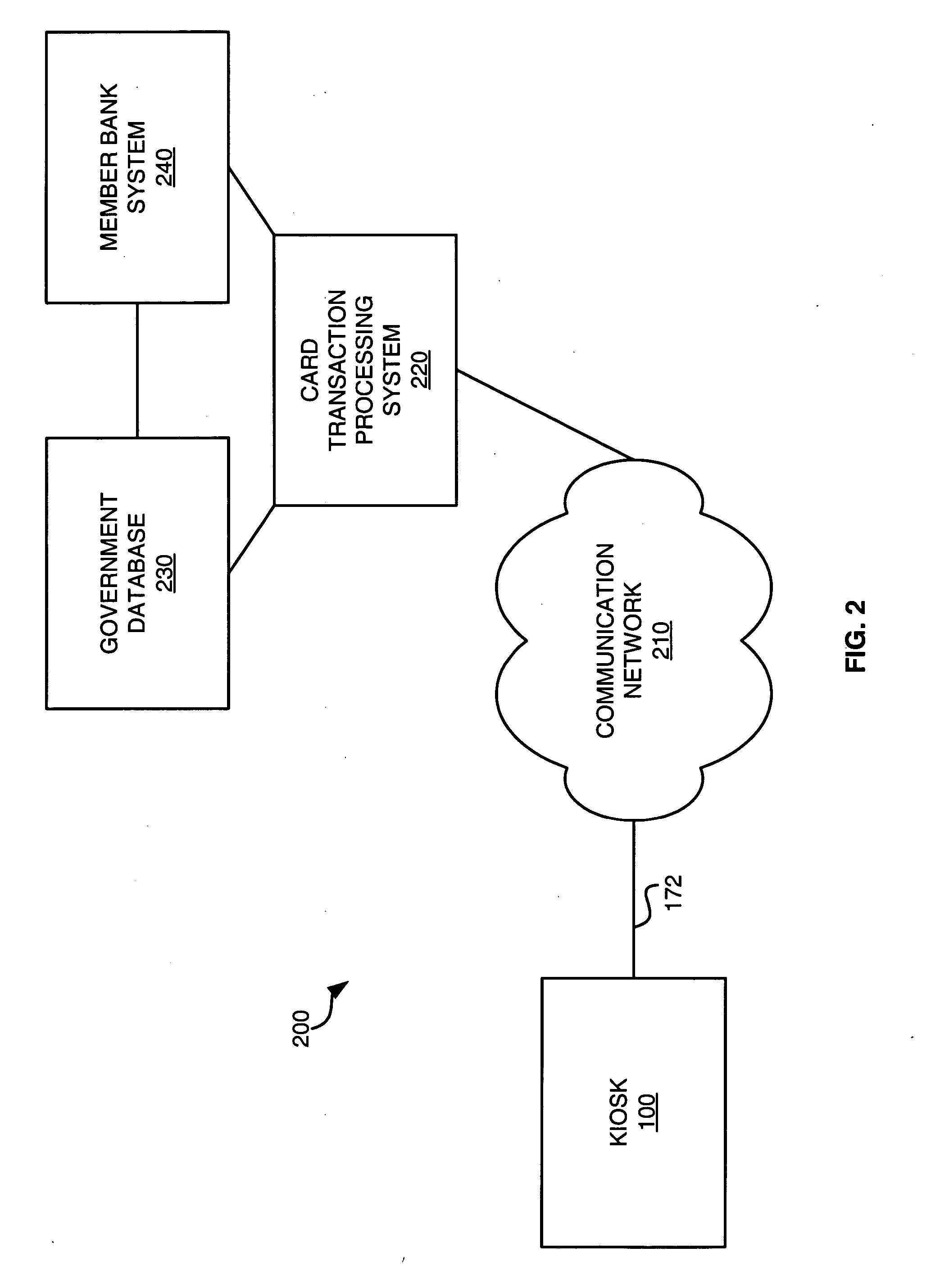

Systems and methods for banking transactions using a stored-value card

InactiveUS20050082364A1Conveniently performedProvide goodComplete banking machinesPre-payment schemesOperating systemStored-value card

Owner:NEXXO FINANCIAL

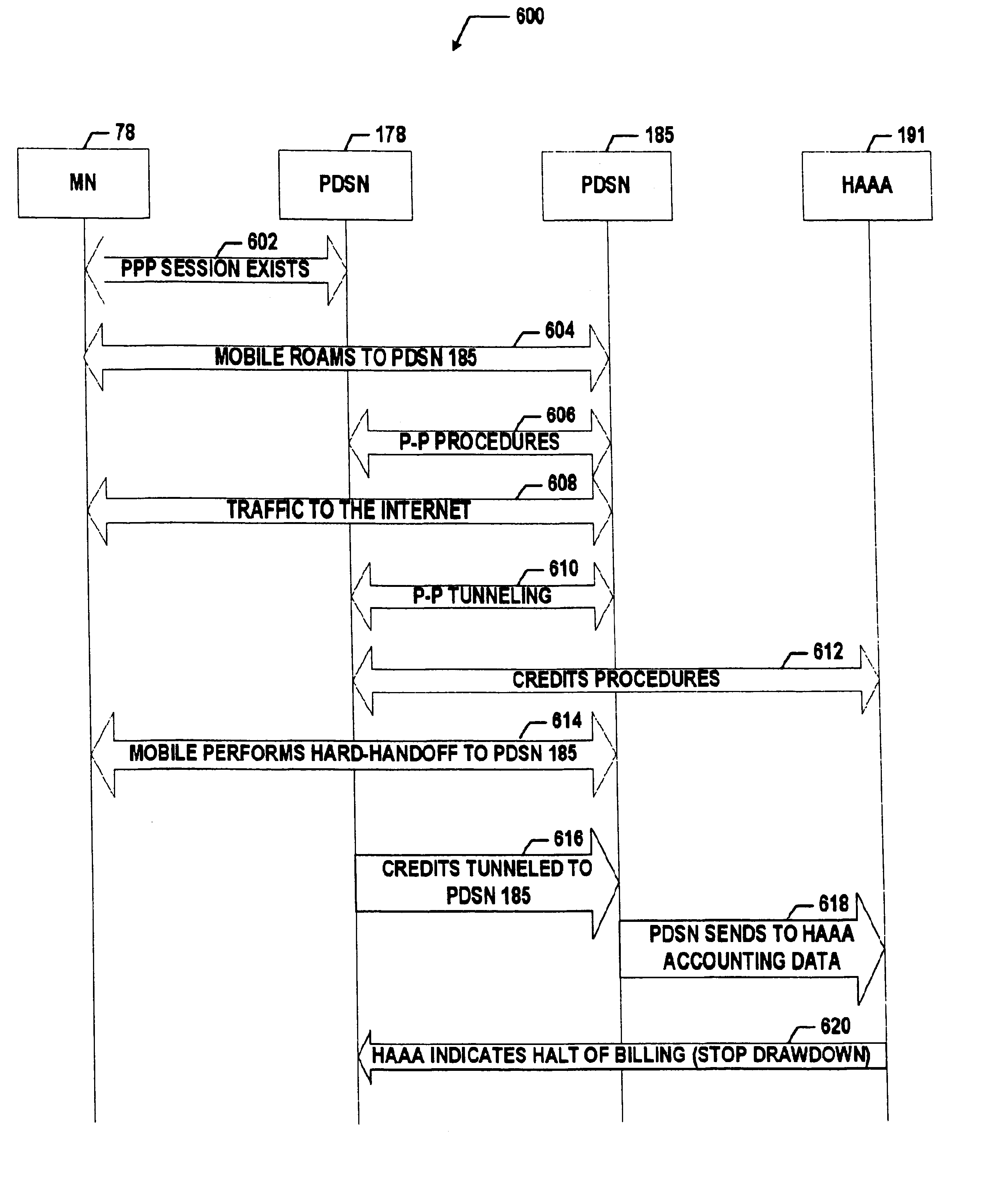

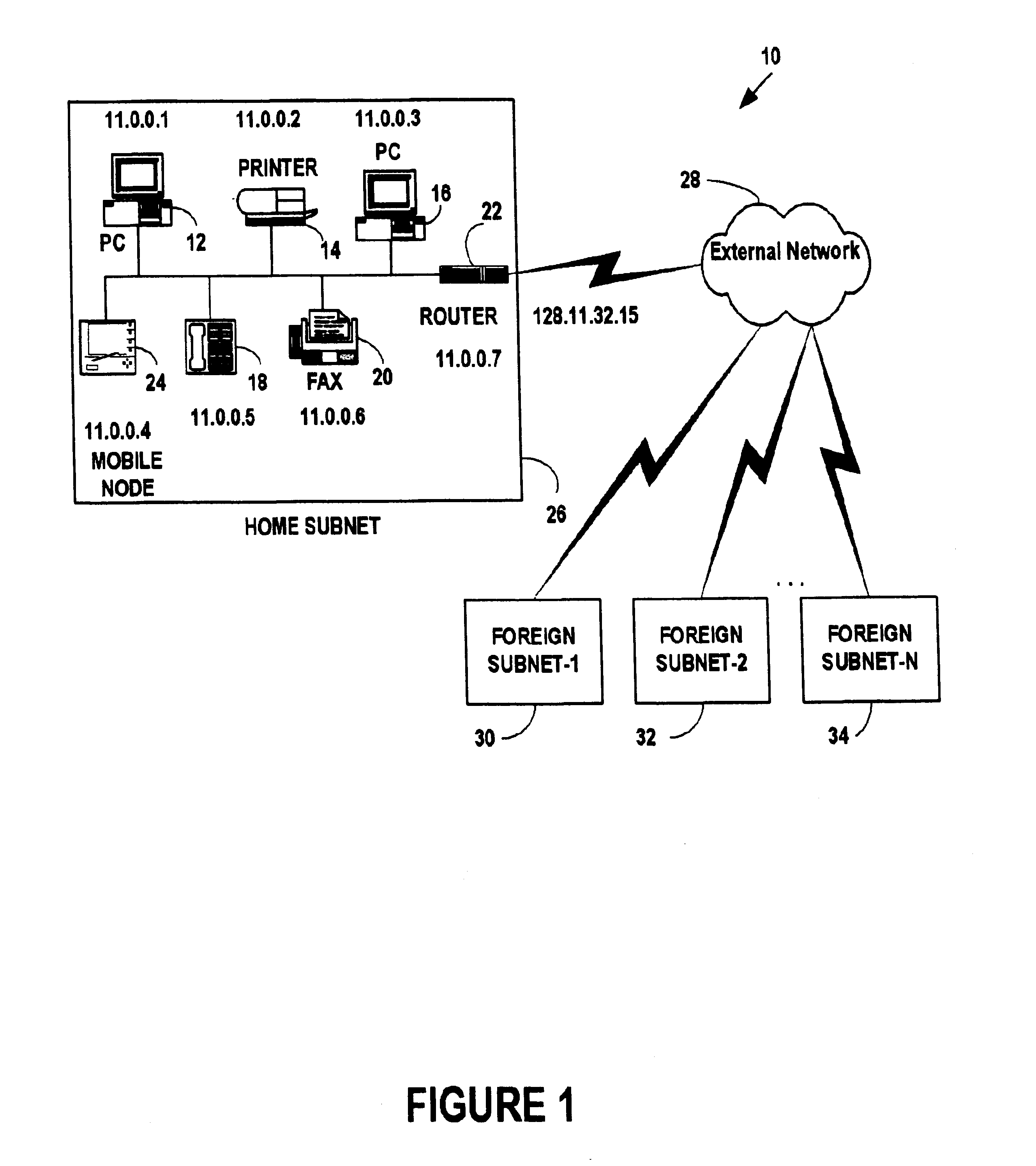

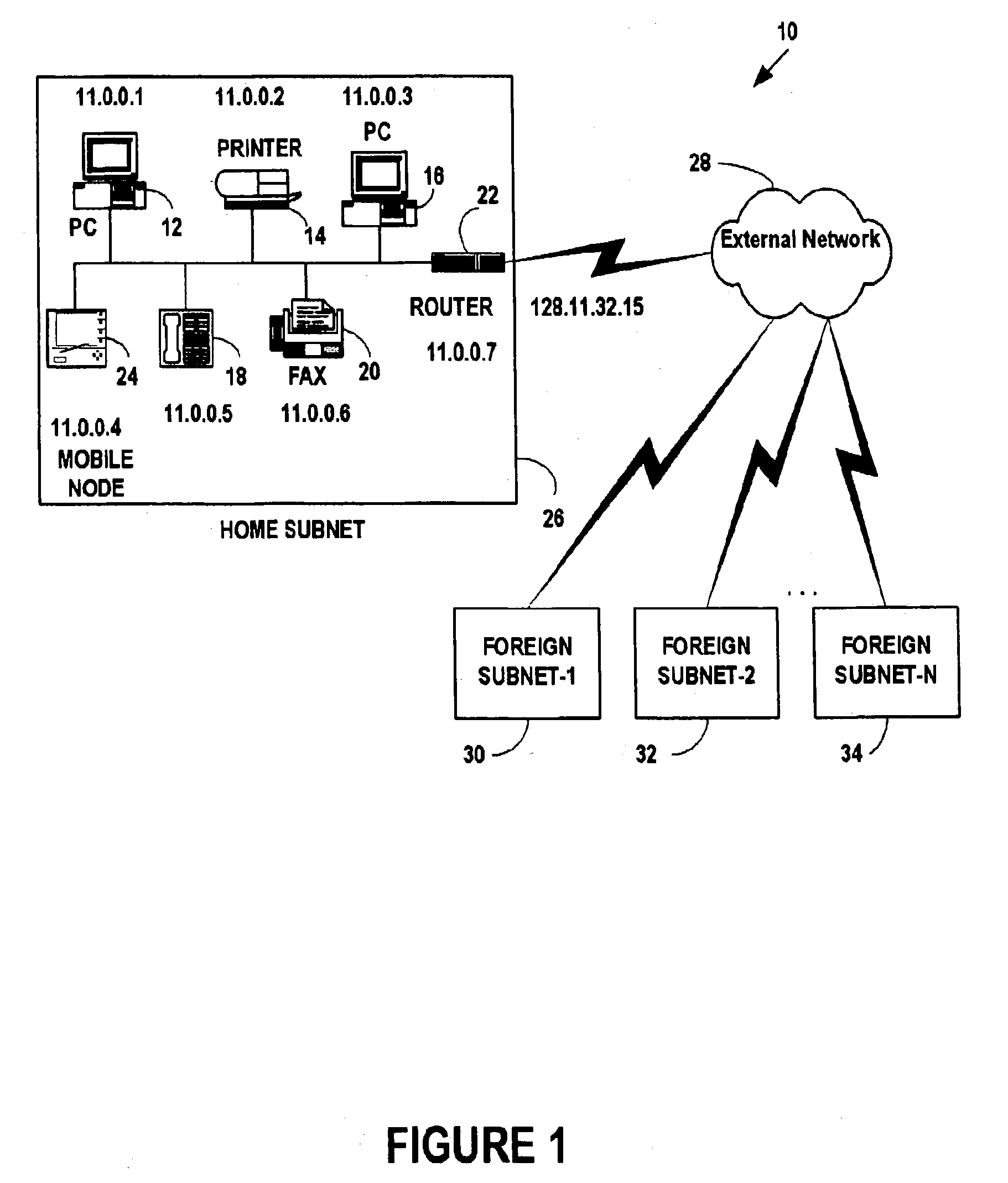

Roaming and hand-off support for prepaid billing for wireless data networks

InactiveUS6829473B2Metering/charging/biilling arrangementsAccounting/billing servicesComputer networkWireless mesh network

A method and apparatus for providing roaming and hand-off support for prepaid billing for wireless prepaid services on a data network may be provided by a first-network-access device carrying on session activity of a wireless communication session with a wireless-mobile node within a first coverage area. The first-network-access device receives blocks of credits drawn from a user account having a cache of available credits for the prepaid-services.The first-network-access device periodically measures usage of the session activity in terms of a first of a plurality of measurement-method parameters. The first-network-access device debits the usage of the session activity from the blocks of credits.After entering its coverage area, the second-network-access device establishes connectivity with the wireless-mobile node. The first-network-access device tunnels to the second-network-access device the session activity and any unused credits. The second-network-access device periodically measures usage of the tunneled session activity in terms of tunneled measurement-method parameters. The second-network-access device debits the usage of the tunneled session activity from the tunneled unused credits.The second-network-access device then establishes independent network access for the session activity. The second-network-access device receives blocks of credits. The second-network-access device periodically measures the usage of the session activity in terms of another of the plurality of measurement-method parameters. The second-network-access device debits the usage of the session activity from the blocks of credits it receives.After hand-off, the first-network-access device may receive from indications to terminate session activity, to stop debiting the usage of the session activity, and / or to return unused credits.

Owner:UTSTARCOM INC

Roaming and hand-off support for prepaid billing for wireless data networks

InactiveUS20040018829A1Metering/charging/biilling arrangementsAccounting/billing servicesWireless mesh networkComputer network

A method and apparatus for providing roaming and hand-off support for prepaid billing for wireless prepaid services on a data network may be provided by a first-network-access device carrying on session activity of a wireless communication session with a wireless-mobile node within a first coverage area. The first-network-access device receives blocks of credits drawn from a user account having a cache of available credits for the prepaid-services. The first-network-access device periodically measures usage of the session activity in terms of a first of a plurality of measurement-method parameters. The first-network-access device debits the usage of the session activity from the blocks of credits. After entering its coverage area, the second-network-access device establishes connectivity with the wireless-mobile node. The first-network-access device tunnels to the second-network-access device the session activity and any unused credits. The second-network-access device periodically measures usage of the tunneled session activity in terms of tunneled measurement-method parameters. The second-network-access device debits the usage of the tunneled session activity from the tunneled unused credits. The second-network-access device then establishes independent network access for the session activity. The second-network-access device receives blocks of credits. The second-network-access device periodically measures the usage of the session activity in terms of another of the plurality of measurement-method parameters. The second-network-access device debits the usage of the session activity from the blocks of credits it receives. After hand-off, the first-network-access device may receive from indications to terminate session activity, to stop debiting the usage of the session activity, and / or to return unused credits.

Owner:UTSTARCOM INC

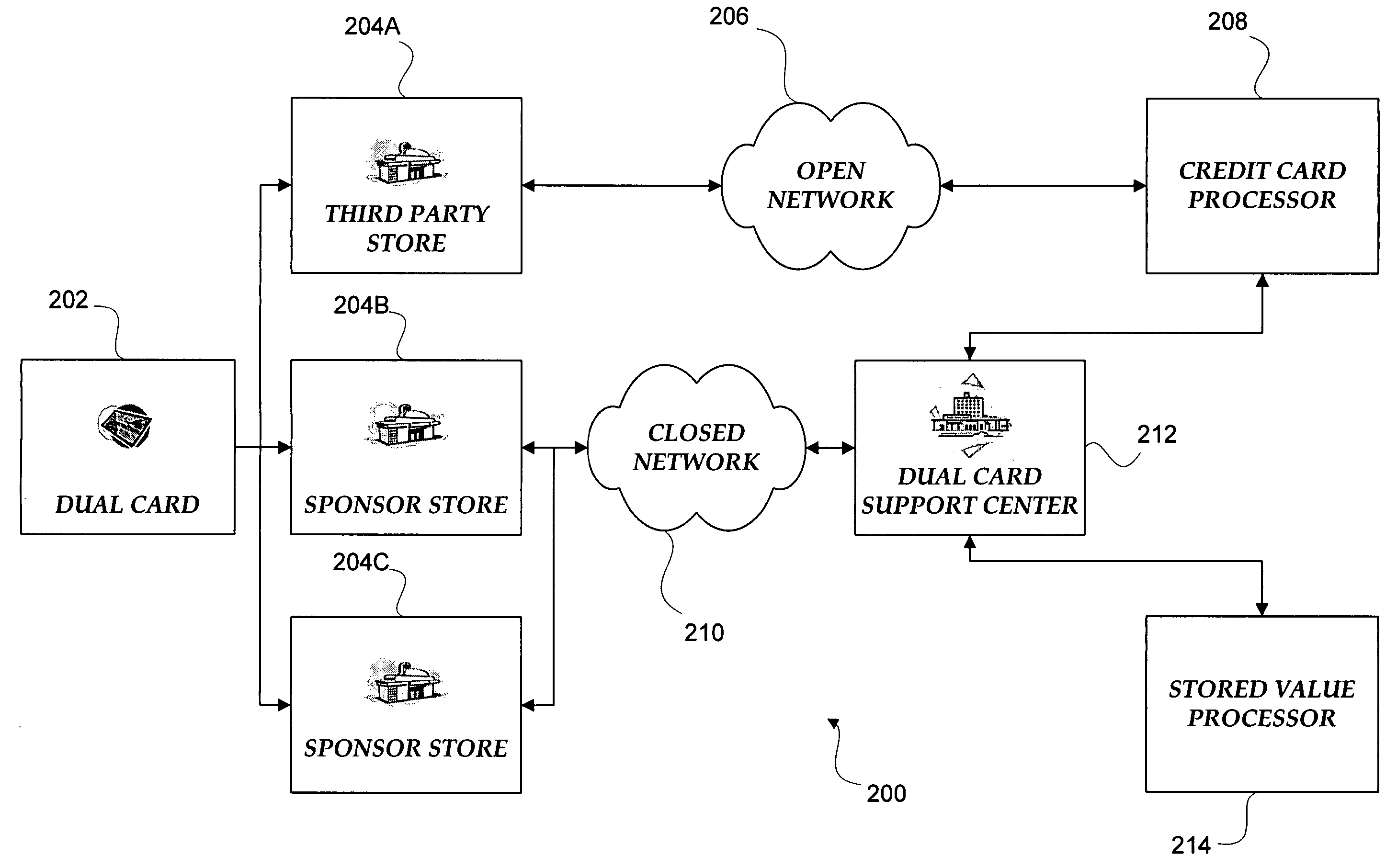

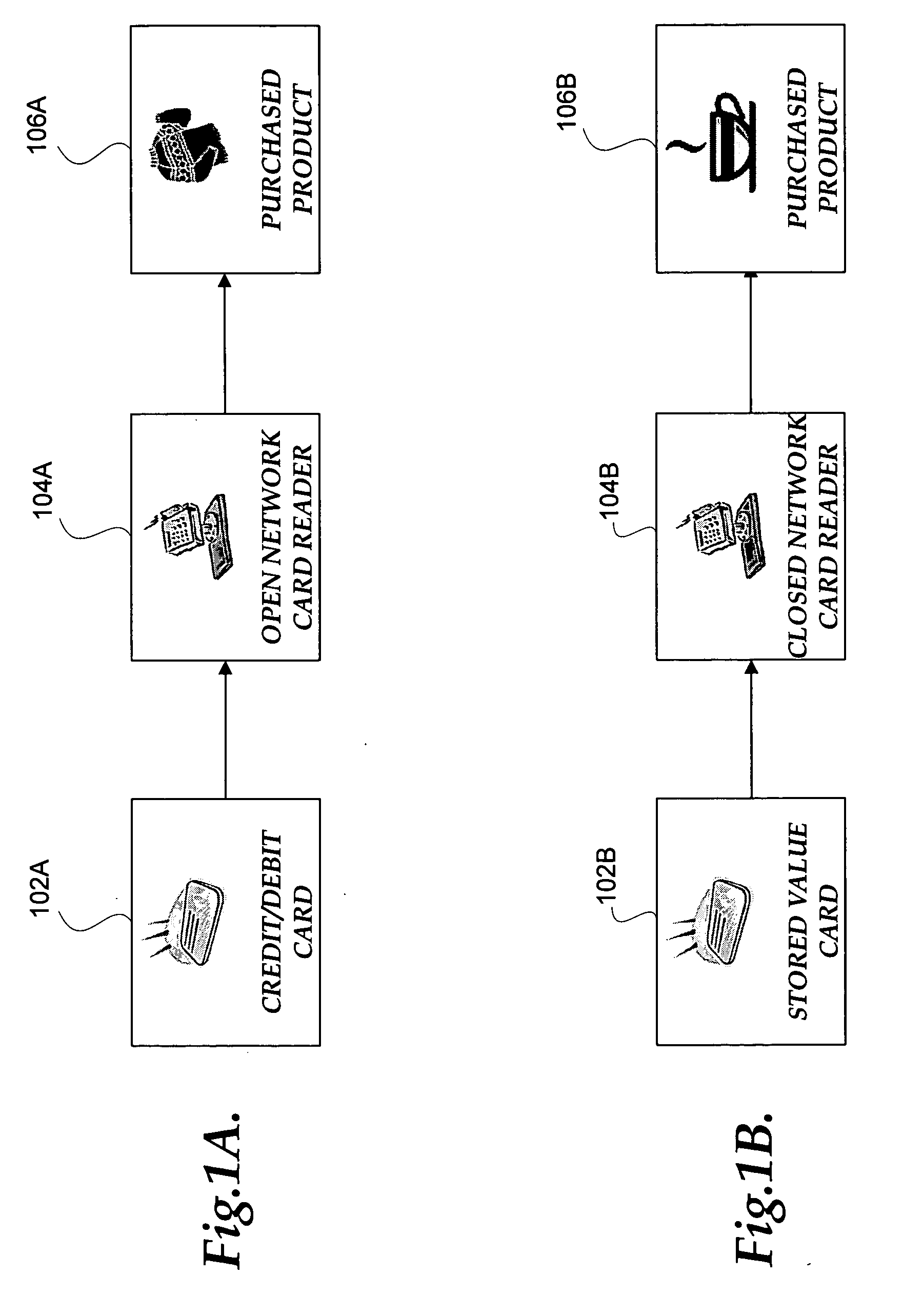

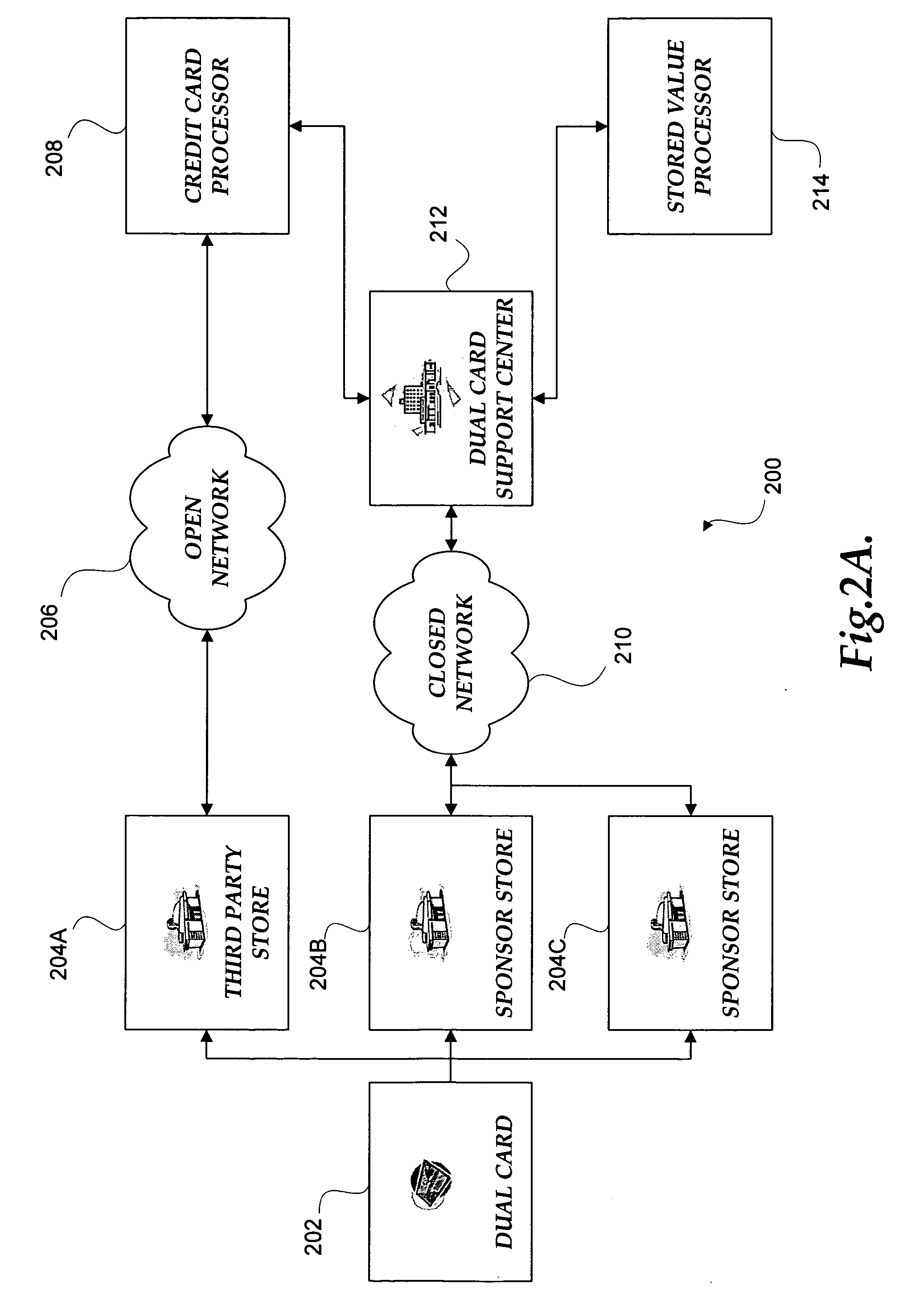

Dual card

A dual card, which facilitates payment for goods or services from either a credit account or a stored value account, operates on both an open network and a closed network. The dual card is a payment card that integrates the ability to provide credit privileges and stored value privileges to a cardholder of the dual card. The features, benefits, and advantages of a stored value card are integrated with the credit card aspects of the dual card. The benefits, features, and advantages of a credit card are integrated with a stored value card.

Owner:STARBUCKS +1

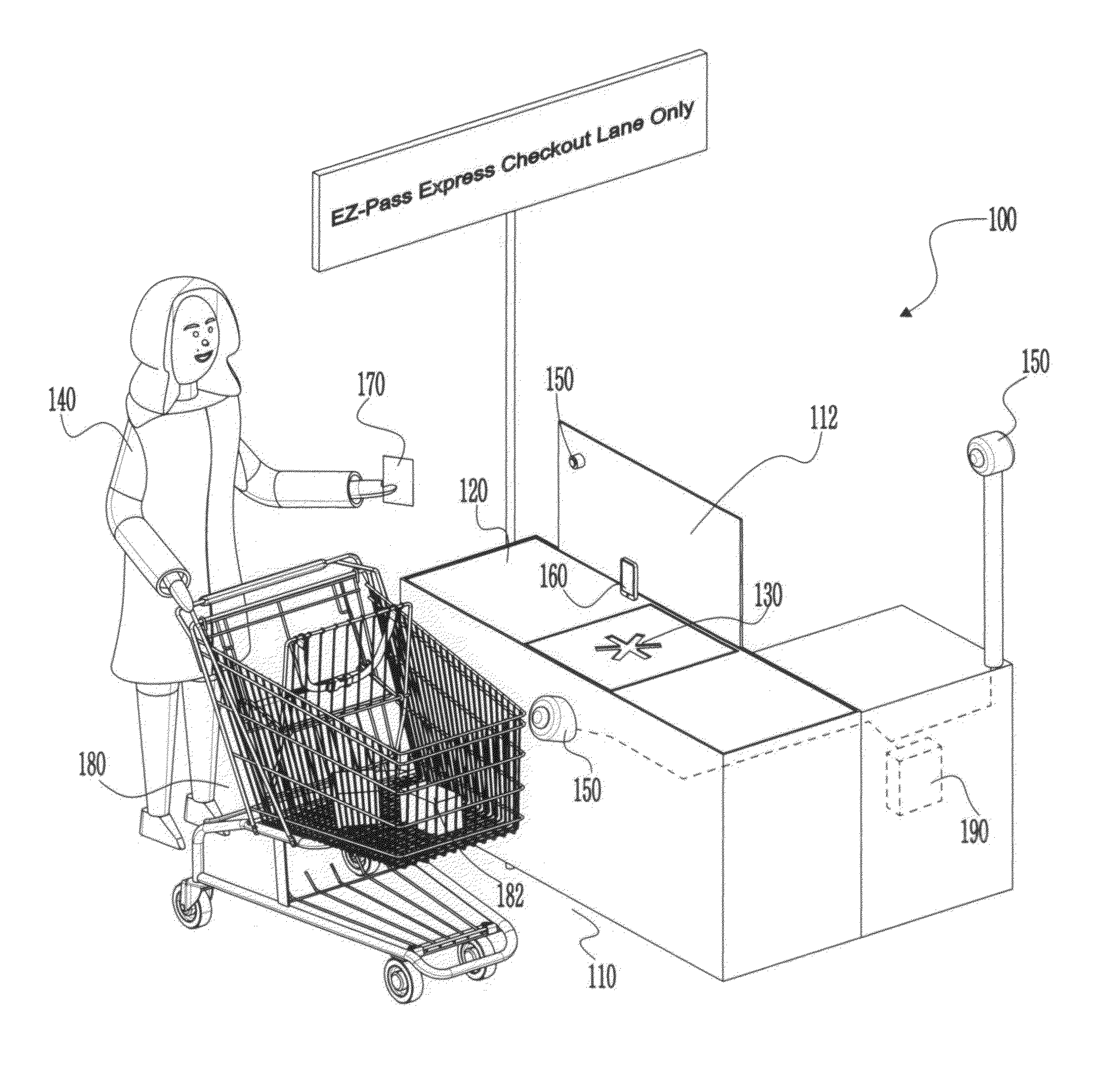

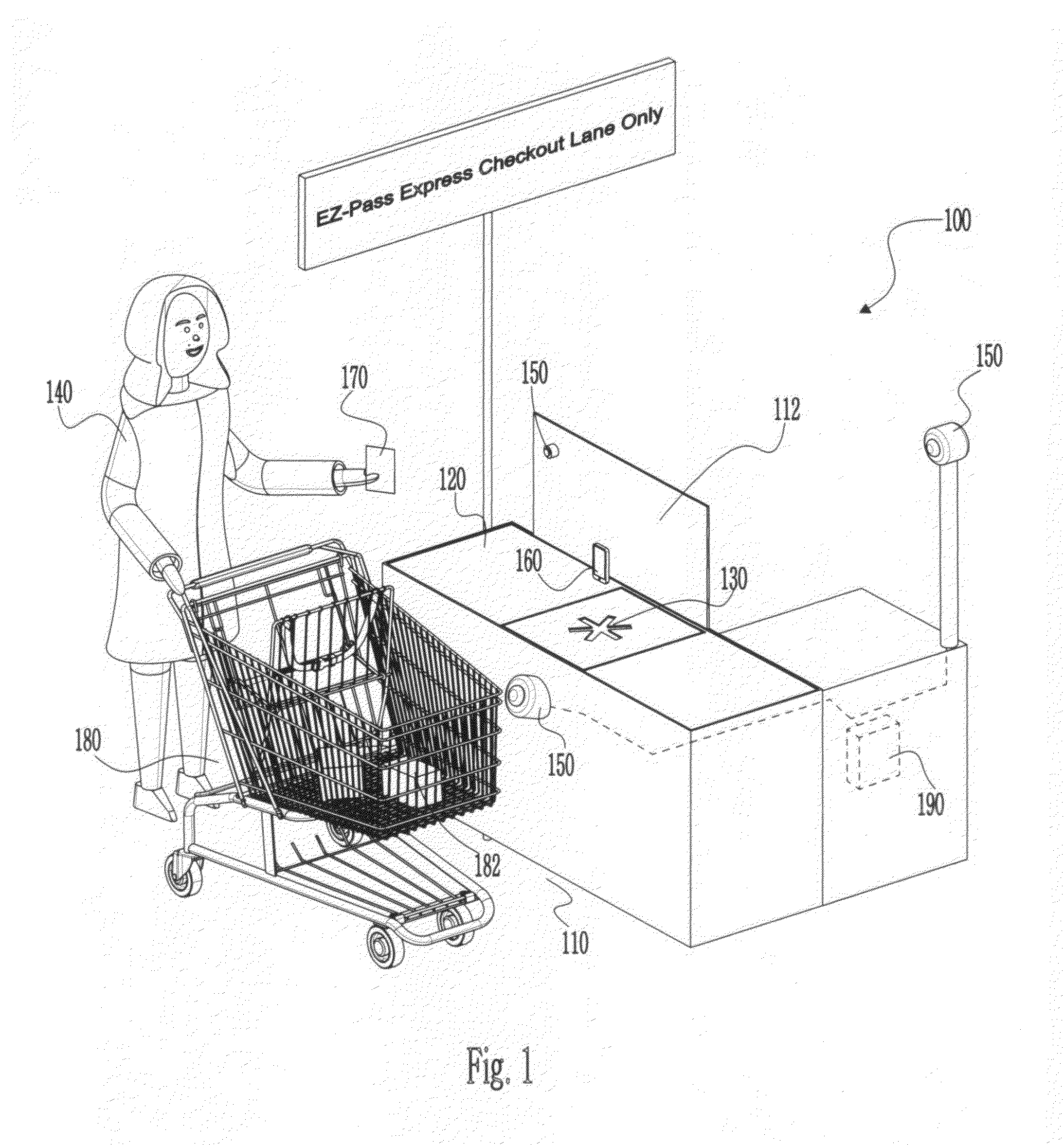

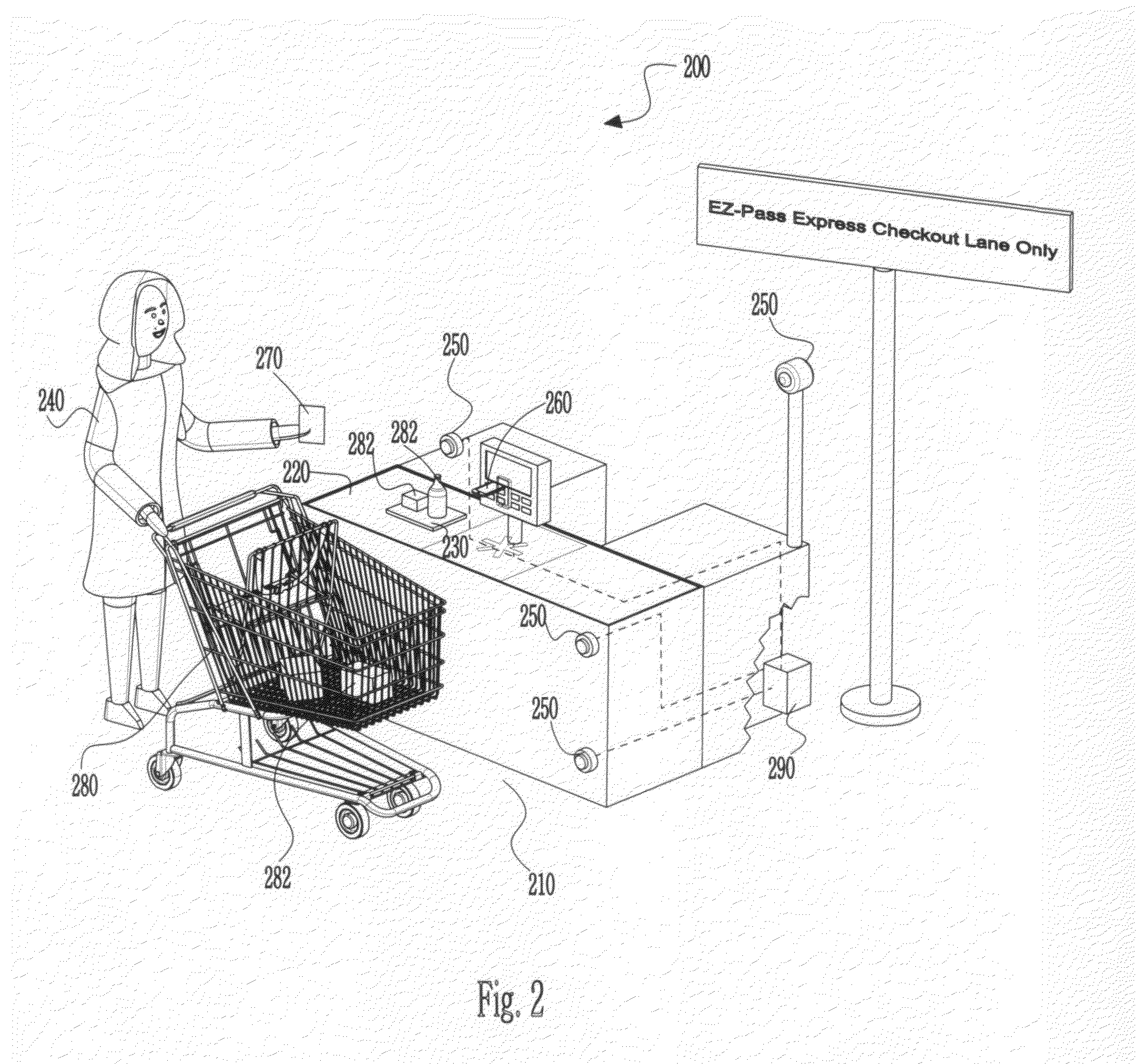

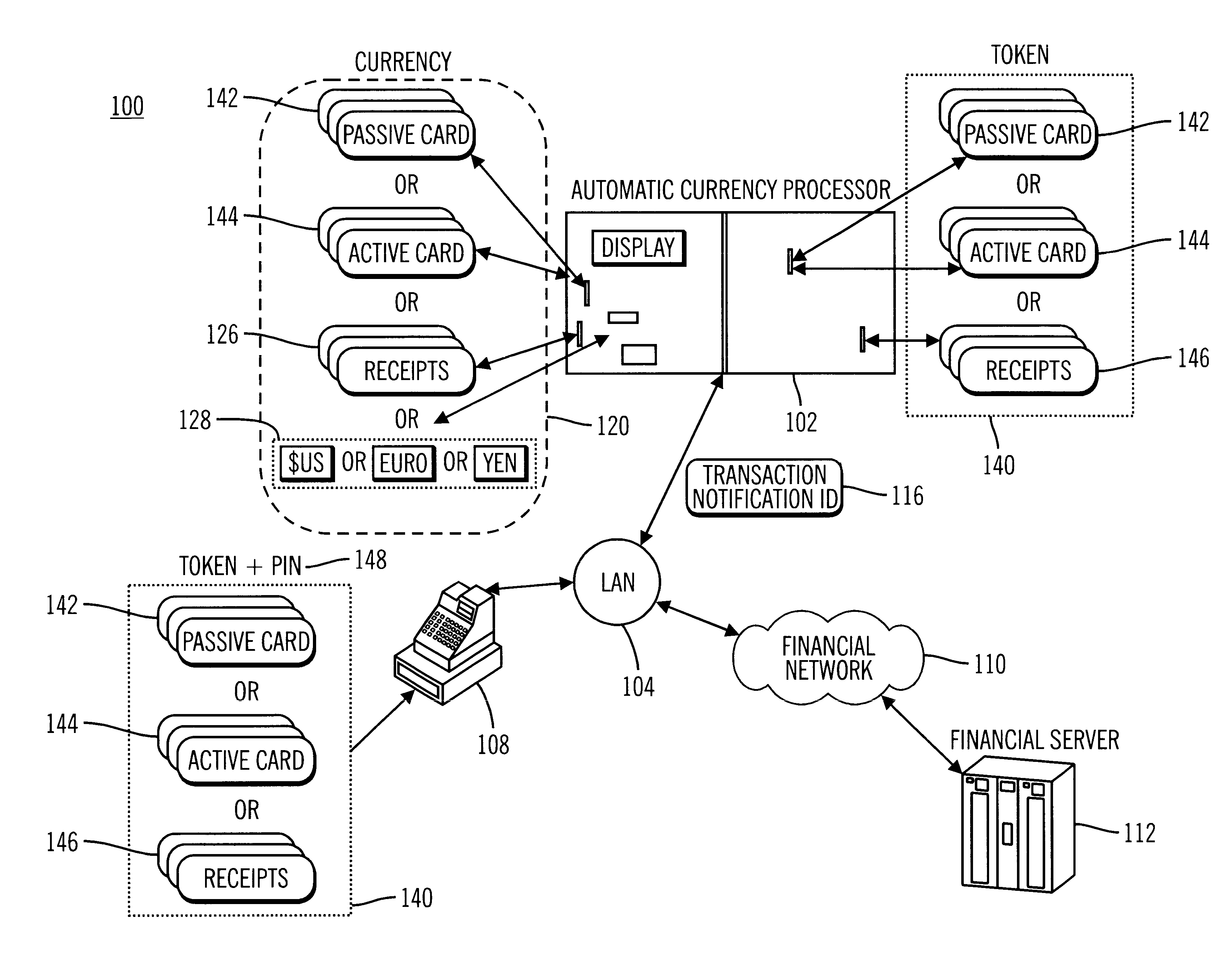

Express easy-pass checkout at grocery stores and retail establishments for preferred members

A grocery store or retail establishment easy-pass (E-Z) lane system for enabling express non-contact payment of a plurality of items is presented including an E-Z pass express checkout lane having at least a scanner for scanning the plurality of items and provided exclusively to preferred members pre-registered with the grocery store or retail establishment. The system includes an RFID antenna positioned about the E-Z pass express checkout lane for communicating with an RFID transponder issued to a preferred member when the RFID transponder is in close proximity to the RFID antenna. The E-Z pass checkout lane is activated thereafter for use by the preferred member for express checkout without the preferred member furnishing direct payment at the E-Z pass express checkout lane via a personal payment account that is separate and distinct from a prepaid vendor-established and maintained purchasing account.

Owner:KOUNTOTSIS THEODOSIOS +1

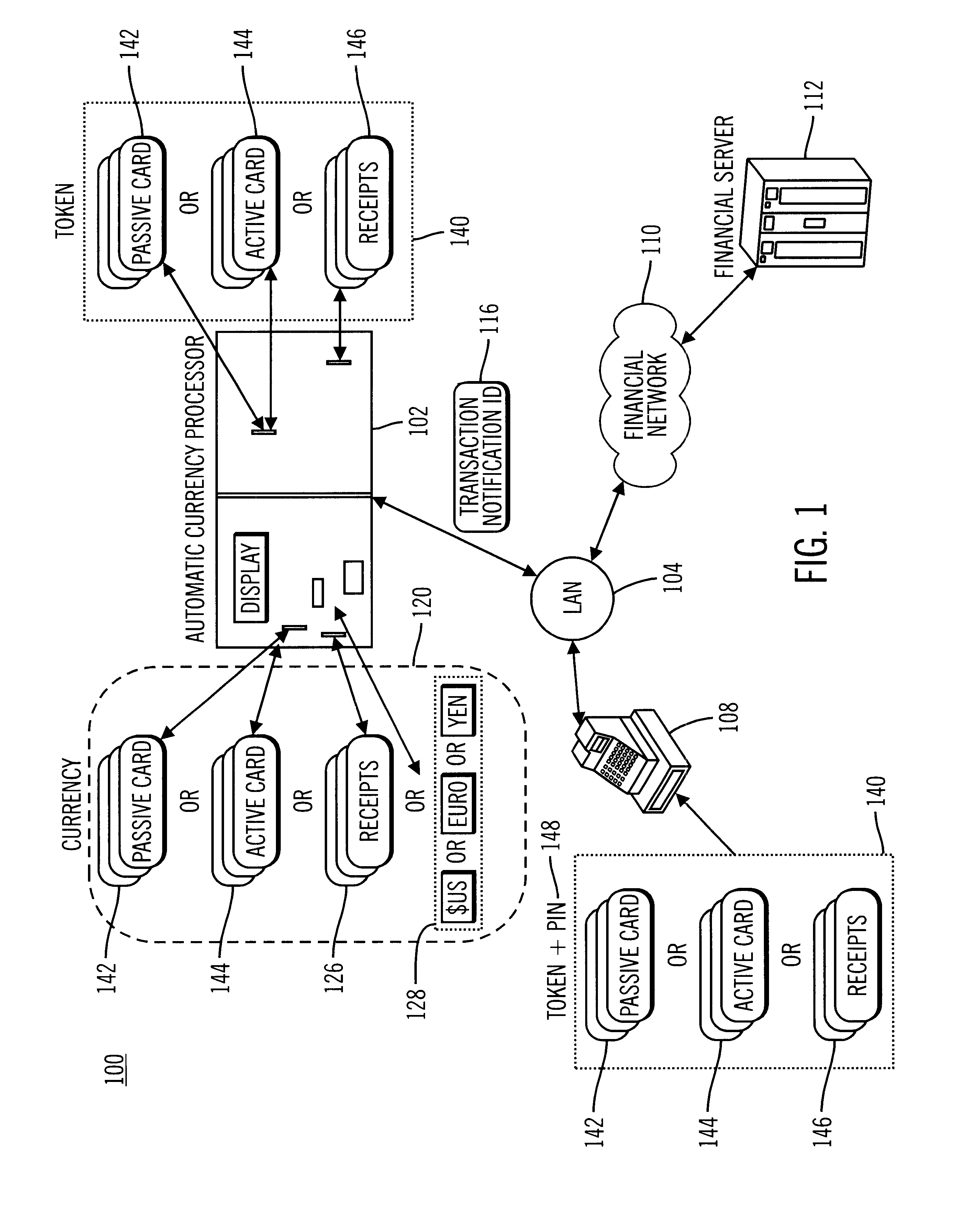

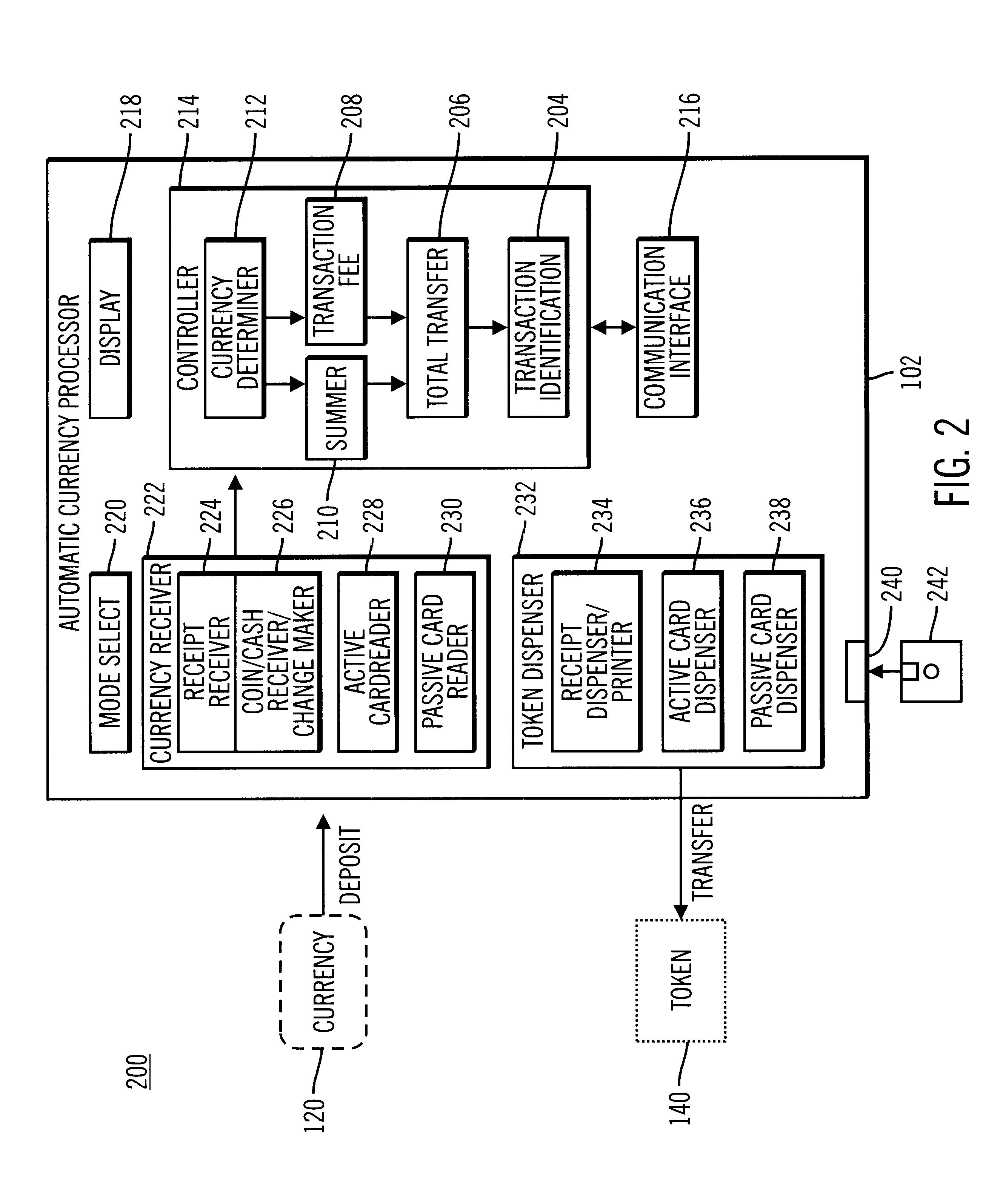

Multiple denomination currency receiving and prepaid card dispensing method and apparatus

InactiveUS6659259B2Digital data processing detailsCounters with additional facilitiesSmart cardDebit card

Owner:DATAWAVE SYST

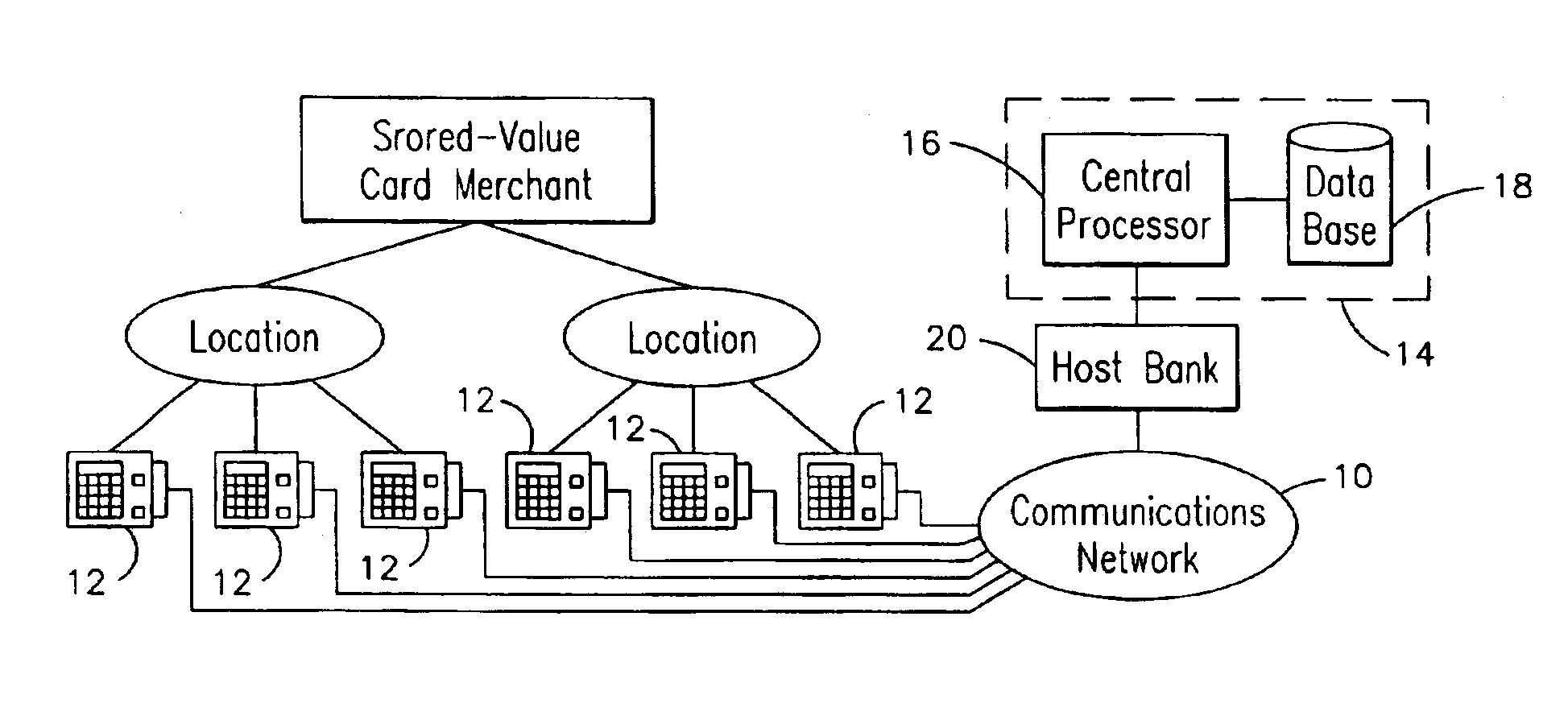

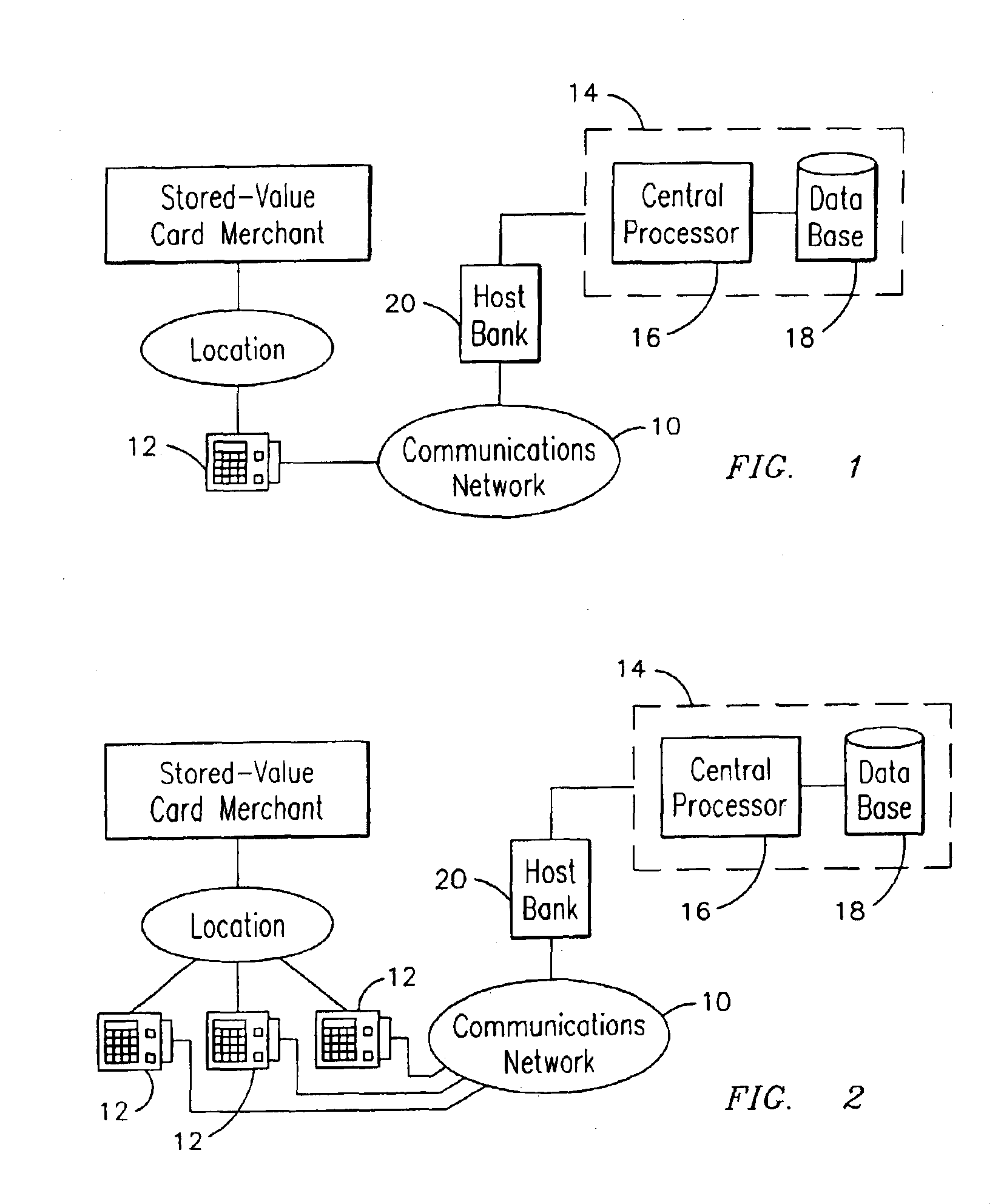

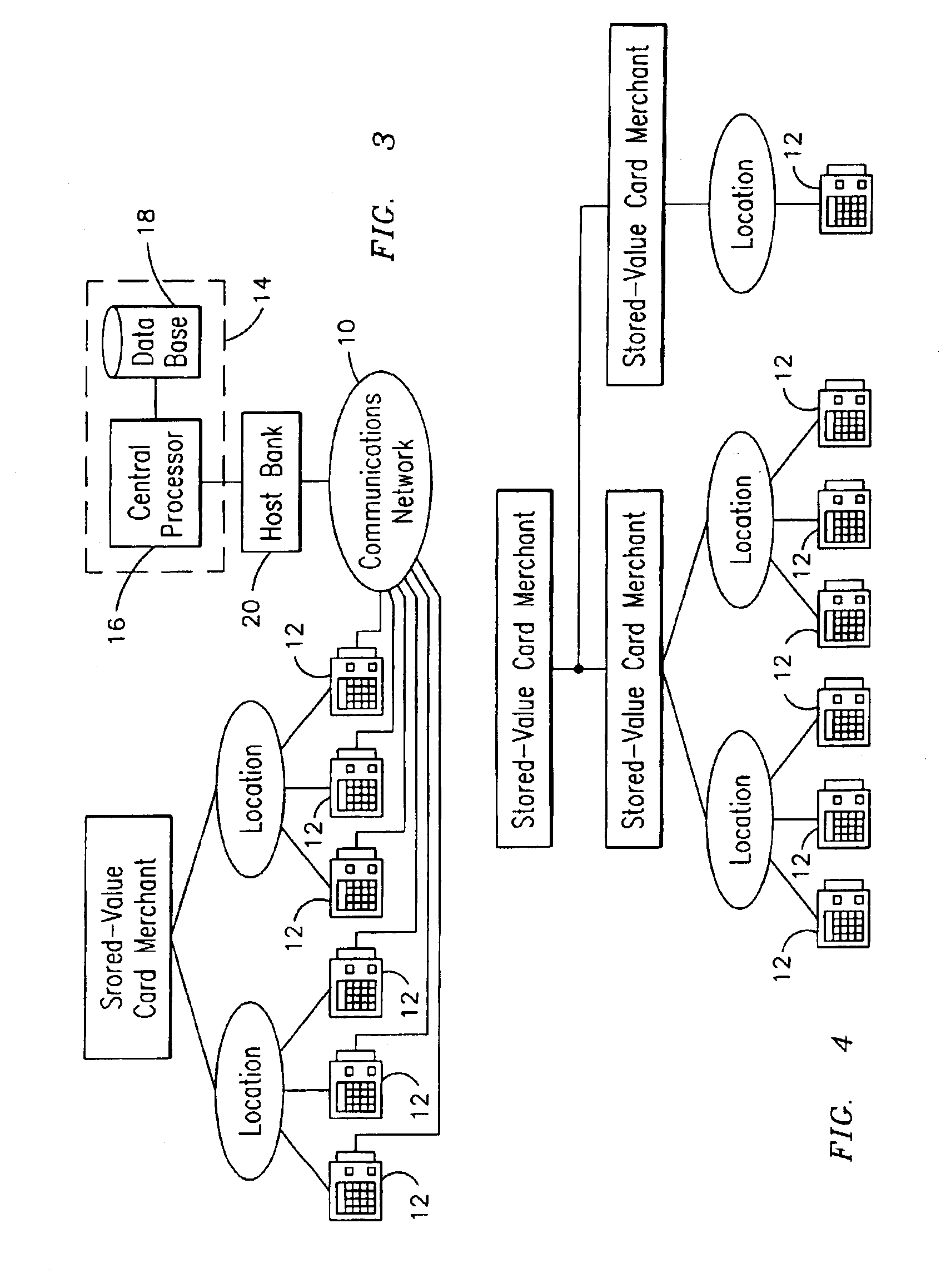

System and method for managing stored-value card data

A computerized system and method for managing stored-value card data over a communications network between a plurality of terminals and a central processor is provided. Each of the terminals is accessible to respective users and is located in a respective location generally remote relative to the central processor. The stored-value card data is configured to securely process in real time stored-value cards transacted by respective users to enable charging prepaid stored-value services to a recipient of the transacted stored-value card. The method allows for providing a database coupled to the central processor. The method further allows for storing in the database a plurality of records comprising stored-value card data for each stored-value card. An associating step allows for associating in each stored record respective identifiers to uniquely match a respective stored-value card and a respective terminal. The associating step is enabled by assigning a “setup” card to the location and capturing the terminal information when a transaction utilizing that card is made. A transmitting step allows for transmitting a request of stored-value card activation to the central processor from a respective requesting terminal, the central processor configured to accept said activation request based on whether the associated identifiers for the stored-value card to be activated match identifiers actually transmitted by the requesting terminal for that stored-value card and terminal.

Owner:E2INTERACTIVE INC D B A E2INTERACTIVE

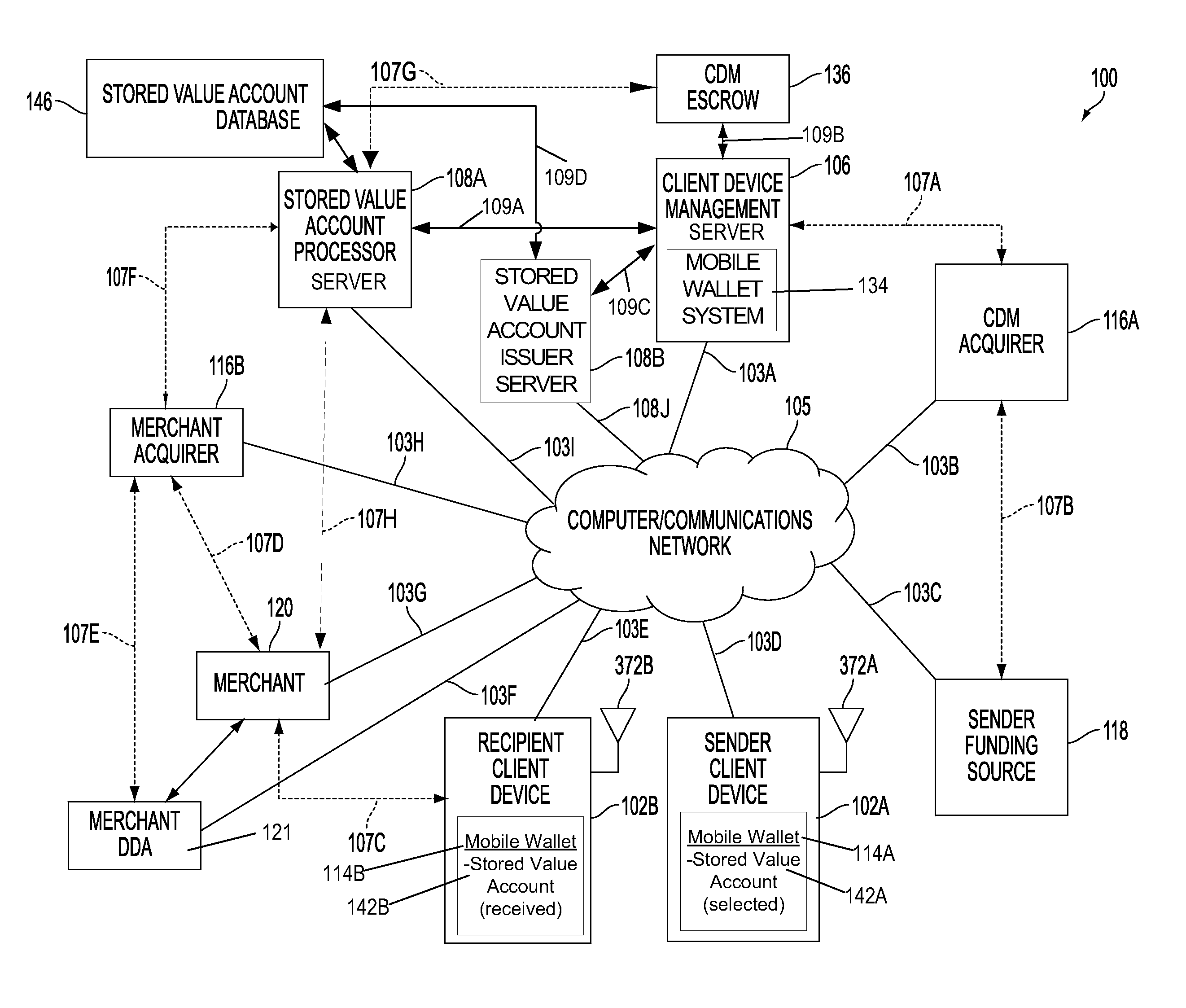

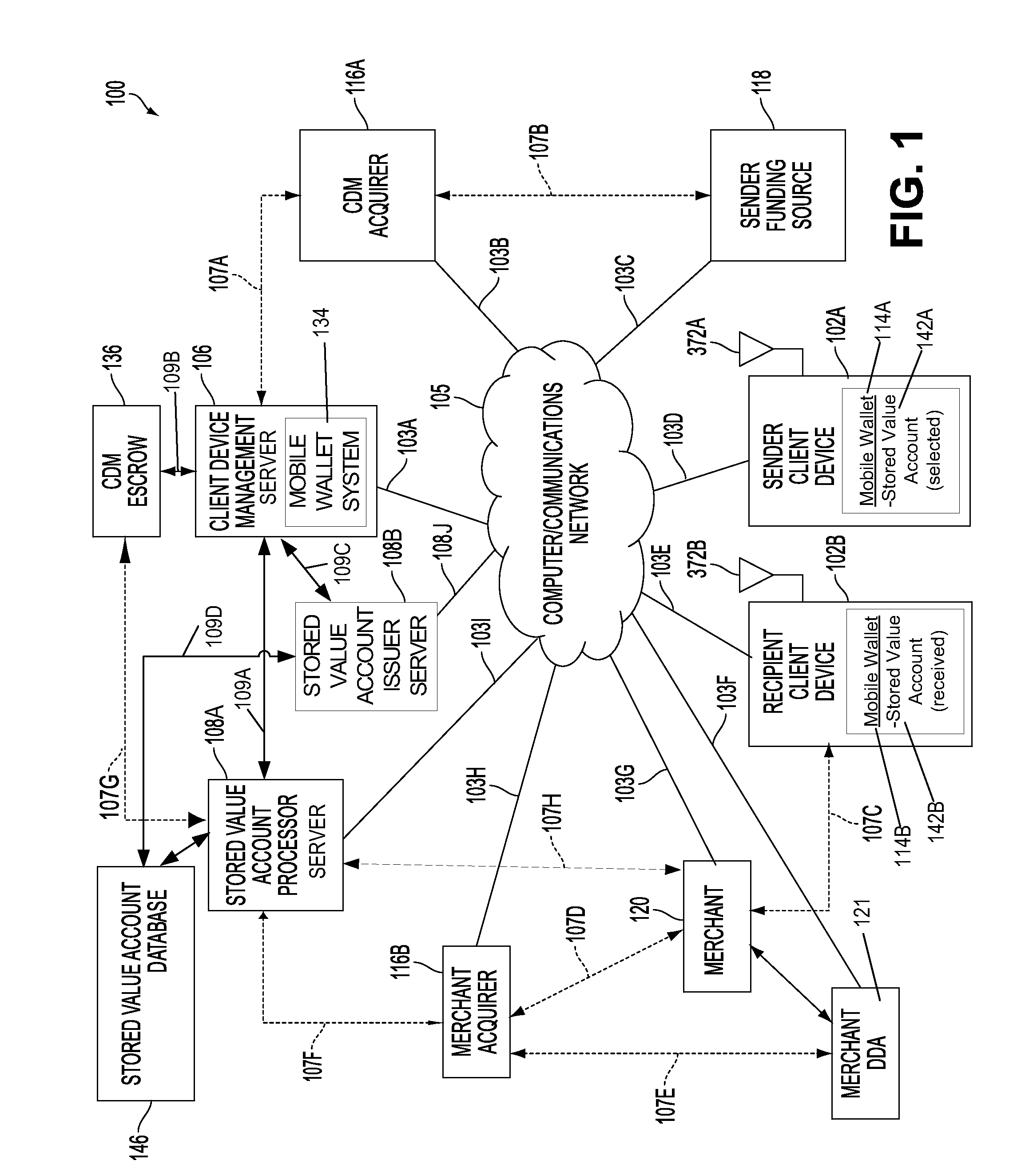

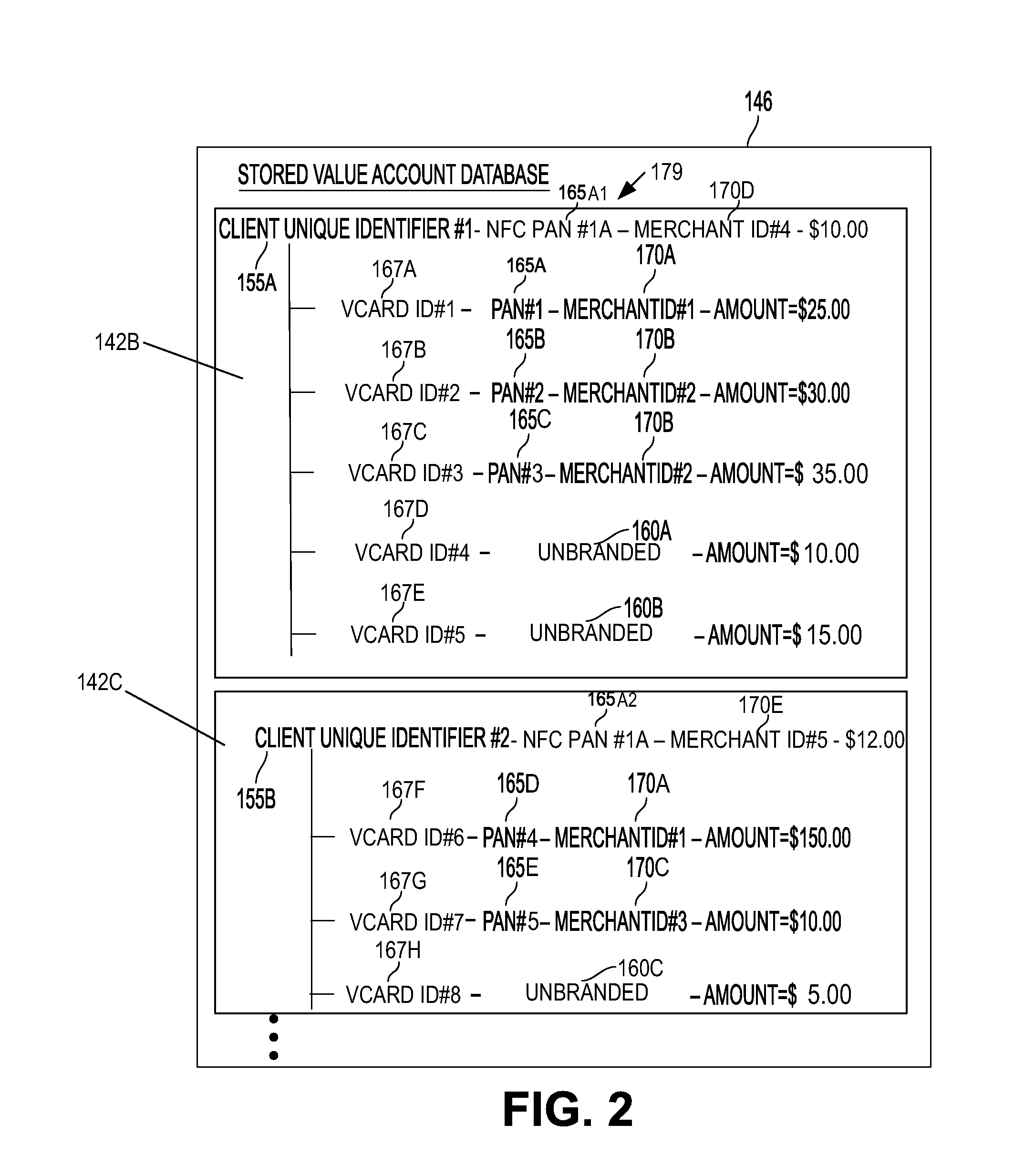

System and method for creating and managing a stored value account associated with a client unique identifier

A method for creating and managing a stored value account associated with a client device is disclosed and may include receiving one of a merchant identifier and an unbranded place holder to associate with the stored value account, receiving an amount of value to assign to the stored value account, and creating a virtual token for the stored value account that is associated with the client device. The method may further include creating a unique identifier associated with a client device, if a stored value account is associated with a merchant identifier, then creating an account number, and if a stored value account is associated with a merchant identifier, then creating an association between the account number and the unique identifier and between the account identifier and the merchant identifier in a database.

Owner:QUALCOMM INC

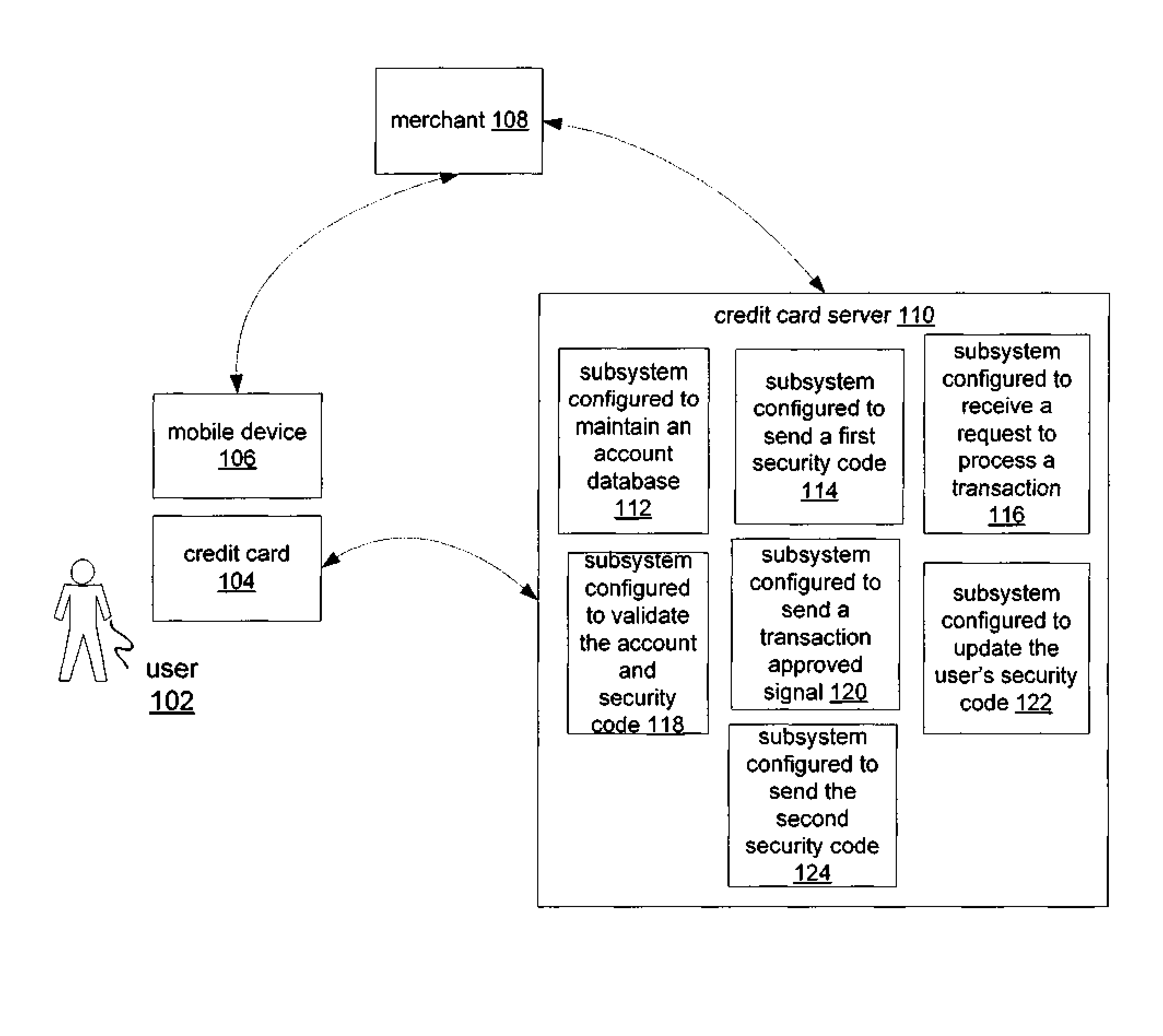

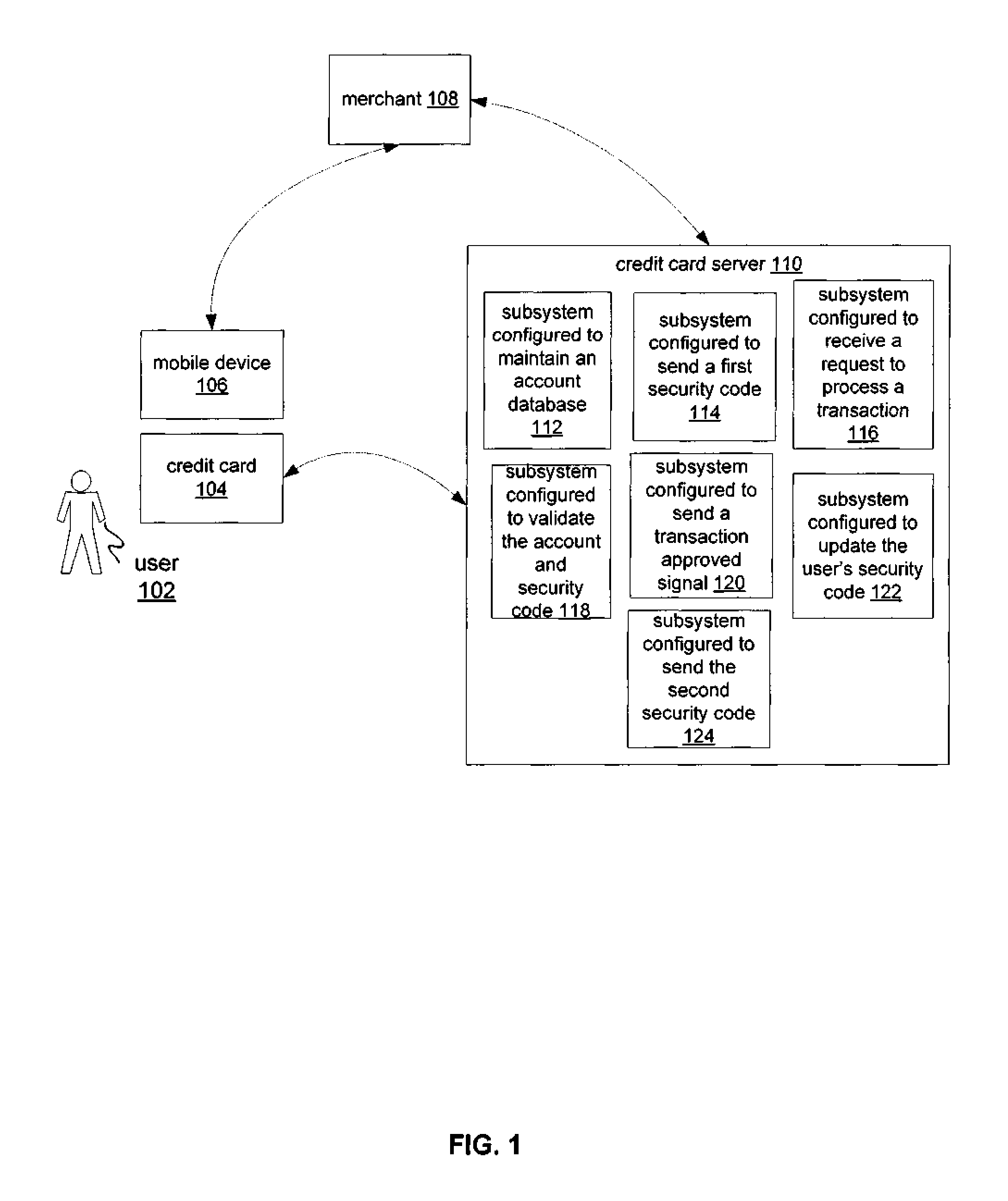

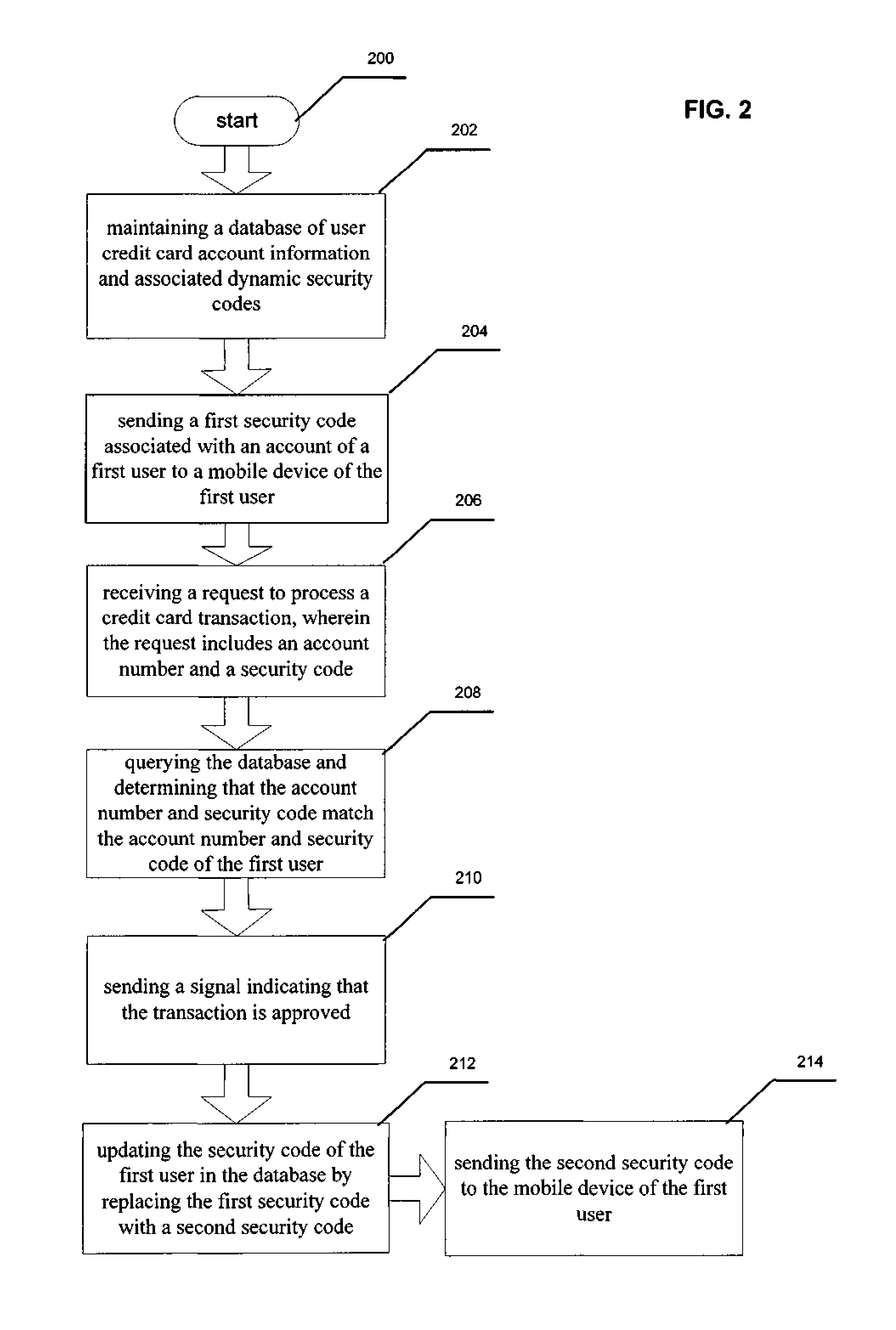

Dynamic credit card security code via mobile device

Systems, methods and computer readable media are disclosed for prioritizing tasks associated with a group of first users based on number of times the first users have monitored the status of a task. In addition to the general system, systems, methods and computer readable media for task prioritizing, the tasks may be prioritized based on the number of first users associated with a task, the importance of each first user associated with a task, and the way the task was identified.

Owner:USAA

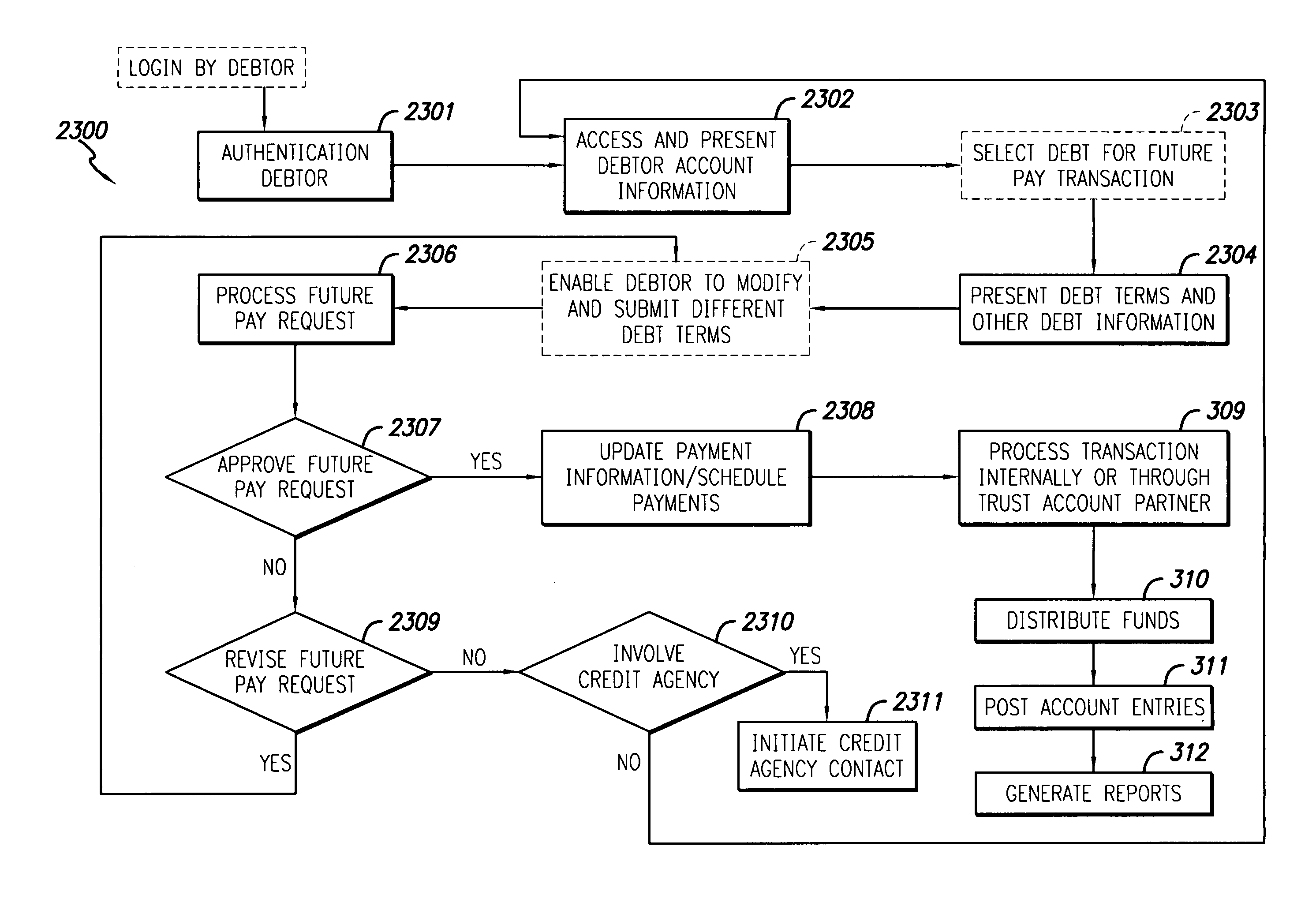

Method for future payment transactions

Owner:MIRITZ INC

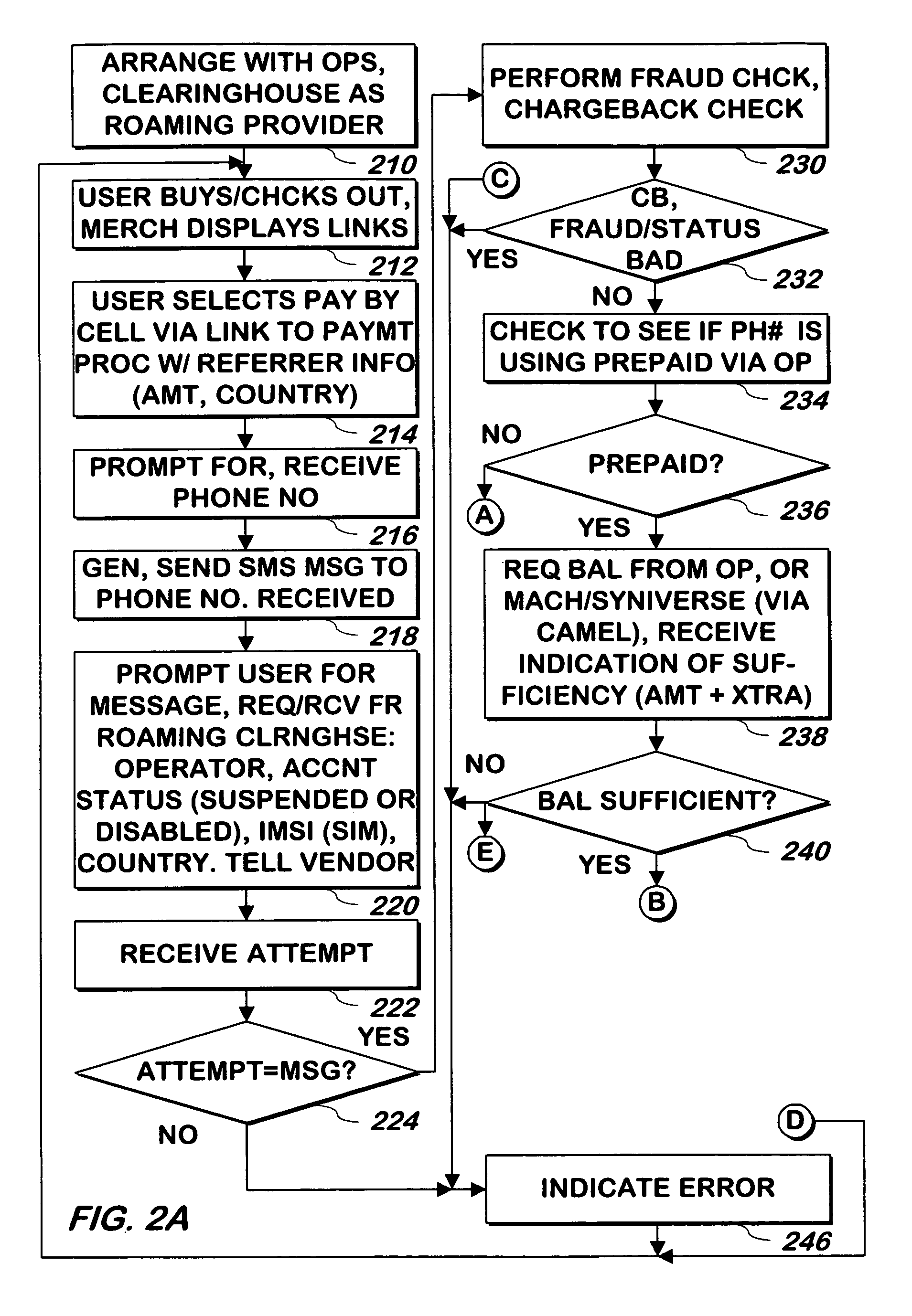

System and method for paying a merchant by a registered user using a cellular telephone account

Owner:PAYFONE

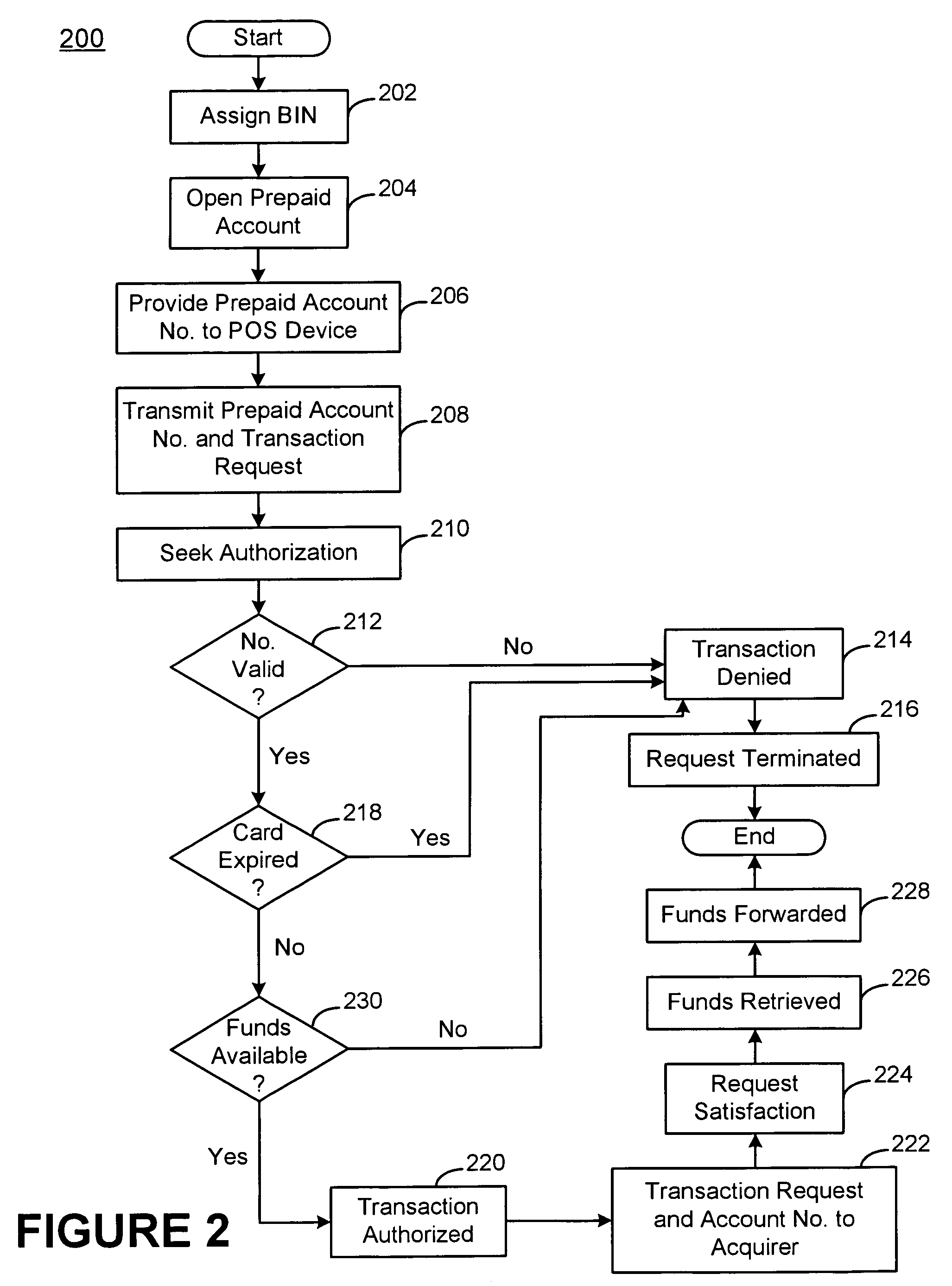

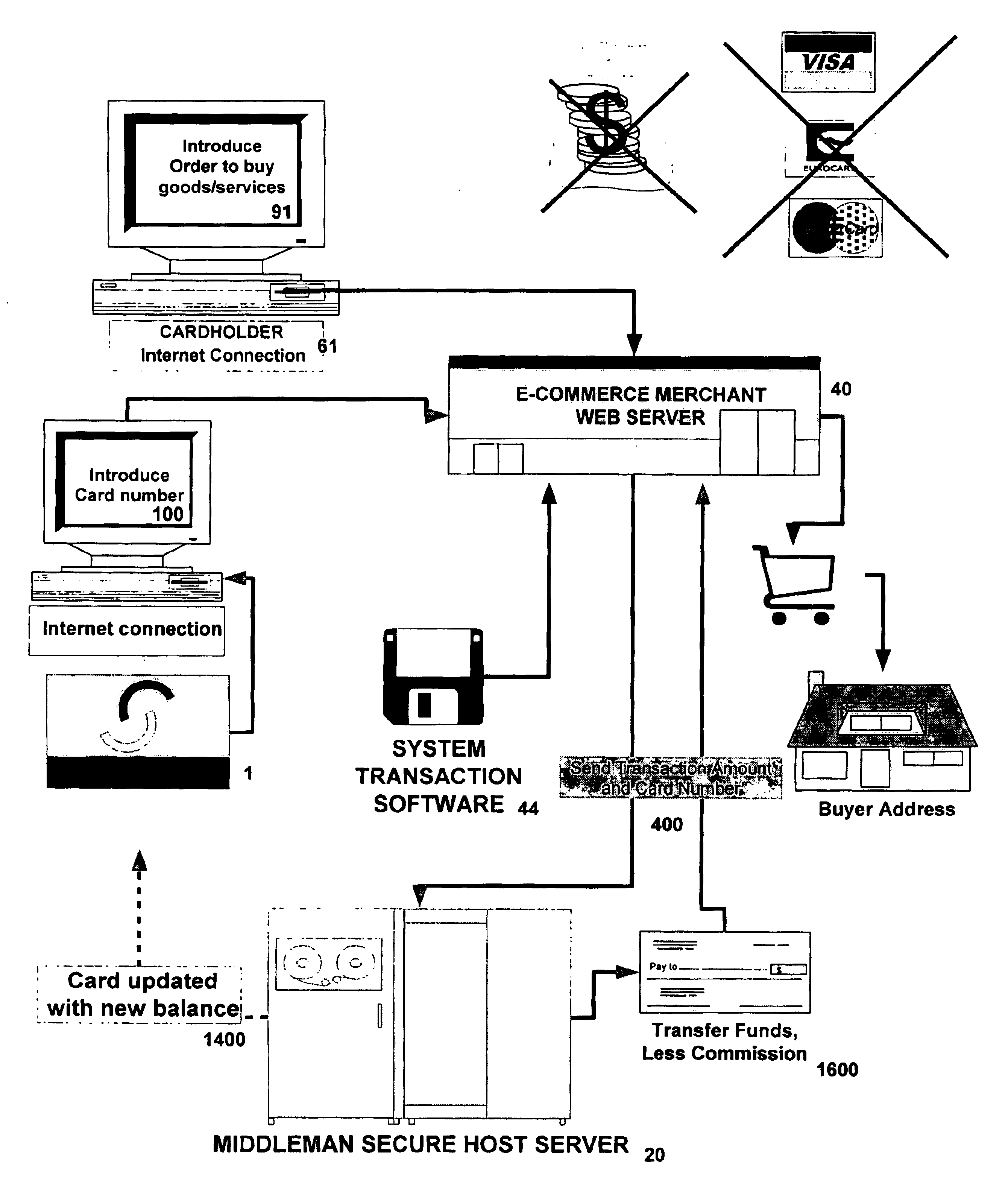

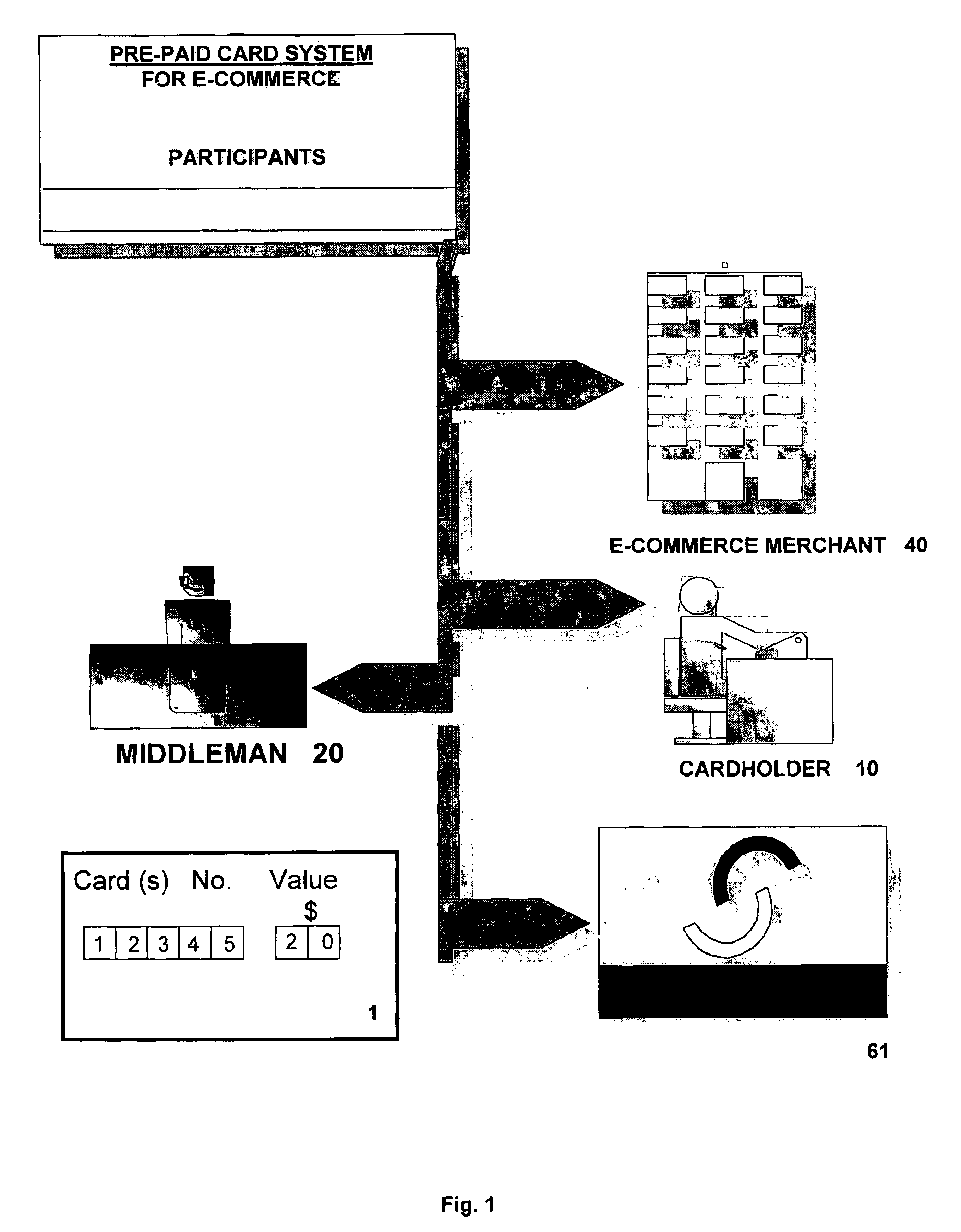

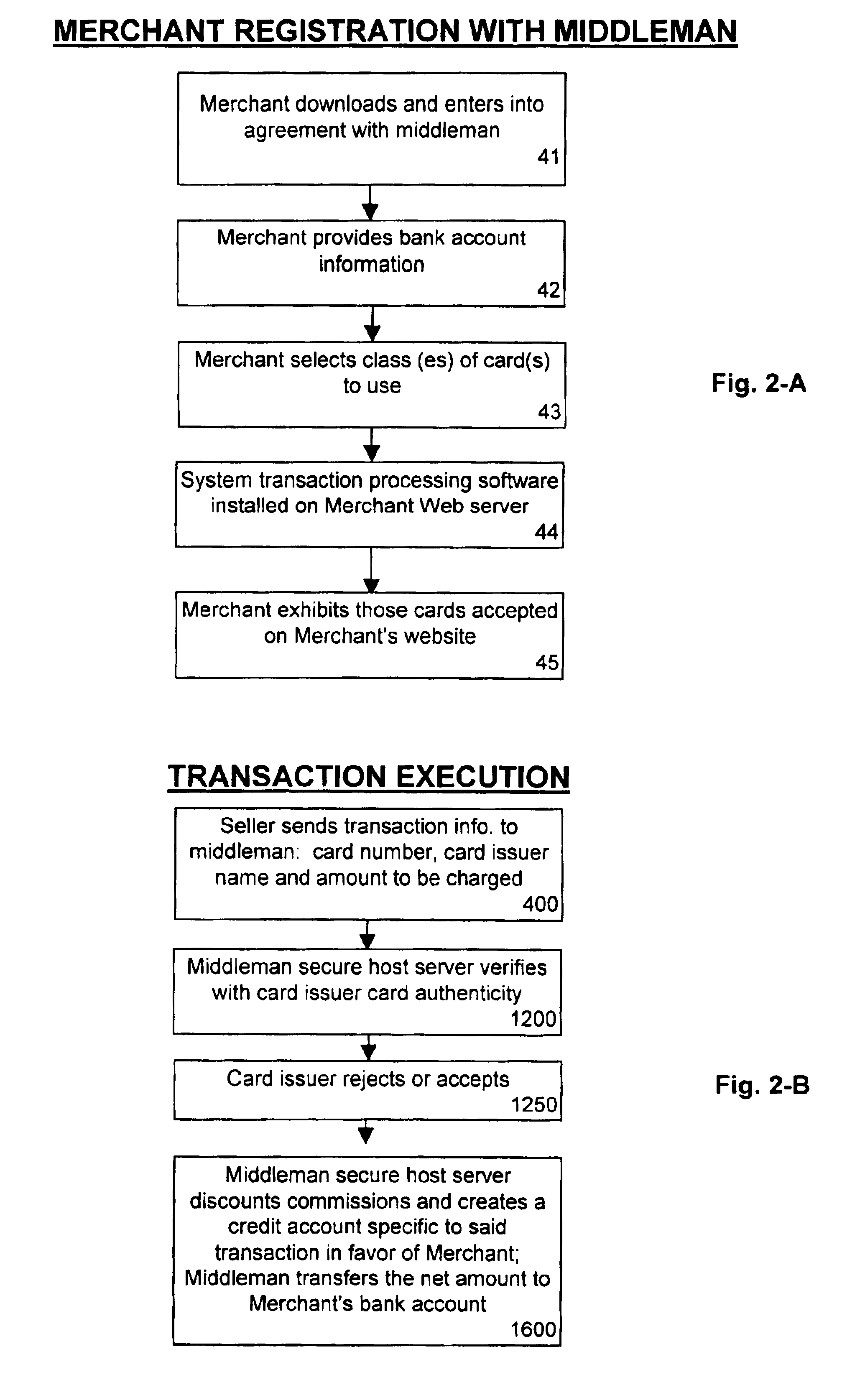

Prepaid card payment system and method for electronic commerce

InactiveUS6805289B2Increase opportunitiesComplete banking machinesCredit registering devices actuationE-commerceApplication software

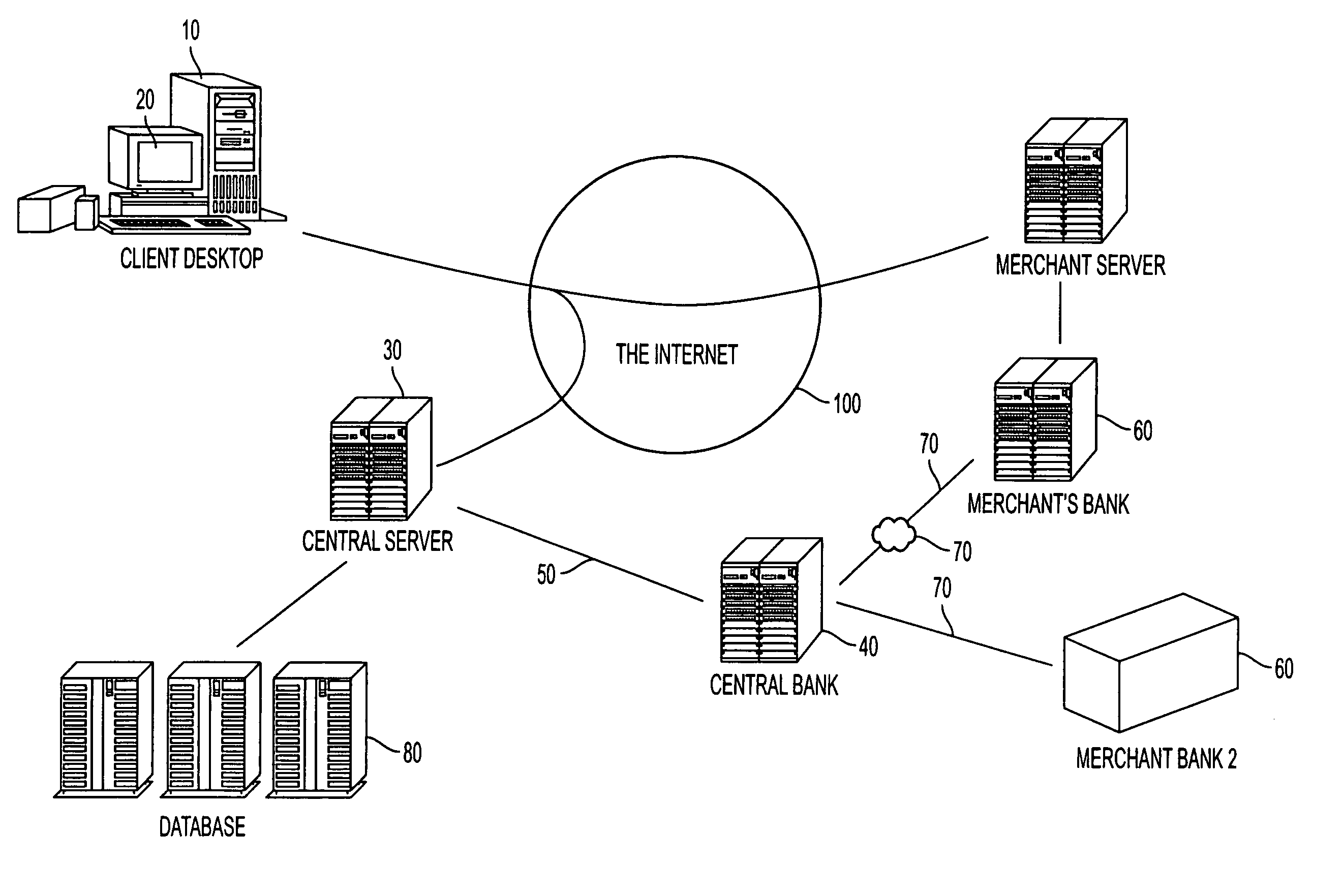

A prepaid card system enabling access to payment-based websites comprising one or more prepaid cards bearing a stored value and authentication codes; one or more cardholder computers communicating via the Internet with merchant websites; a "middleman" server communicating via an intranet with merchants, prepaid card issuers and said merchants' banks; one or more searchable databases hosted on the middleman's server storing merchant registration information, card issuer information; one or more software applications to interpret the data sent by the middleman server for the identification and online deduction of the amount of value used in a transaction from a prepaid card; one or more software applications for reception and transmission of cardholder card data; and one or more software applications for transaction accounting and payment processing between merchants, card issuers, middleman and merchants' banks. A prepaid card payment method for electronic commerce is also disclosed and claimed.

Owner:NORIEGA EDUARDO +1

Systems and methods for authentication of a virtual stored value card

InactiveUS20100063906A1Improve securityAvoid lossComplete banking machinesFinanceComputer hardwareService provision

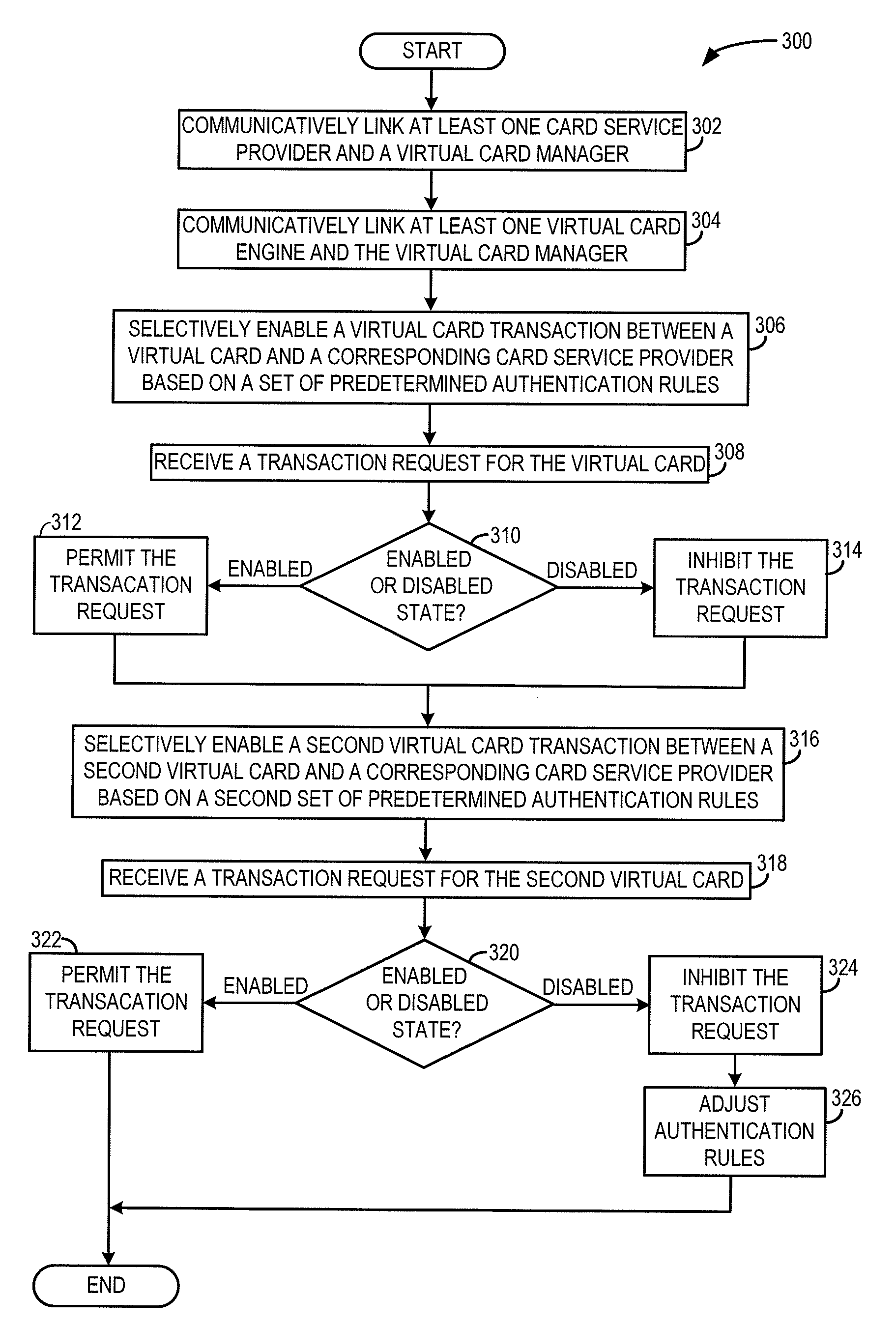

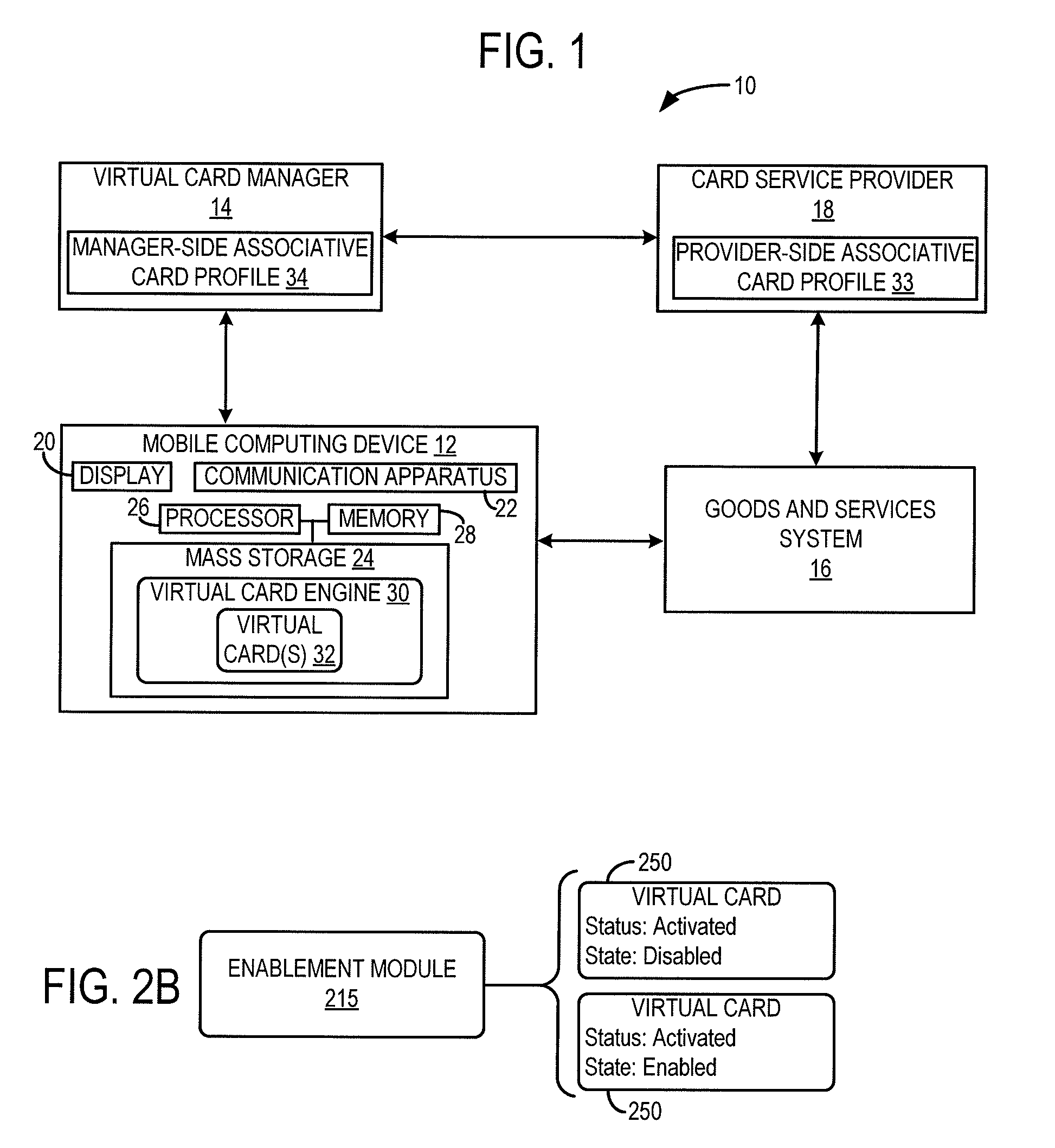

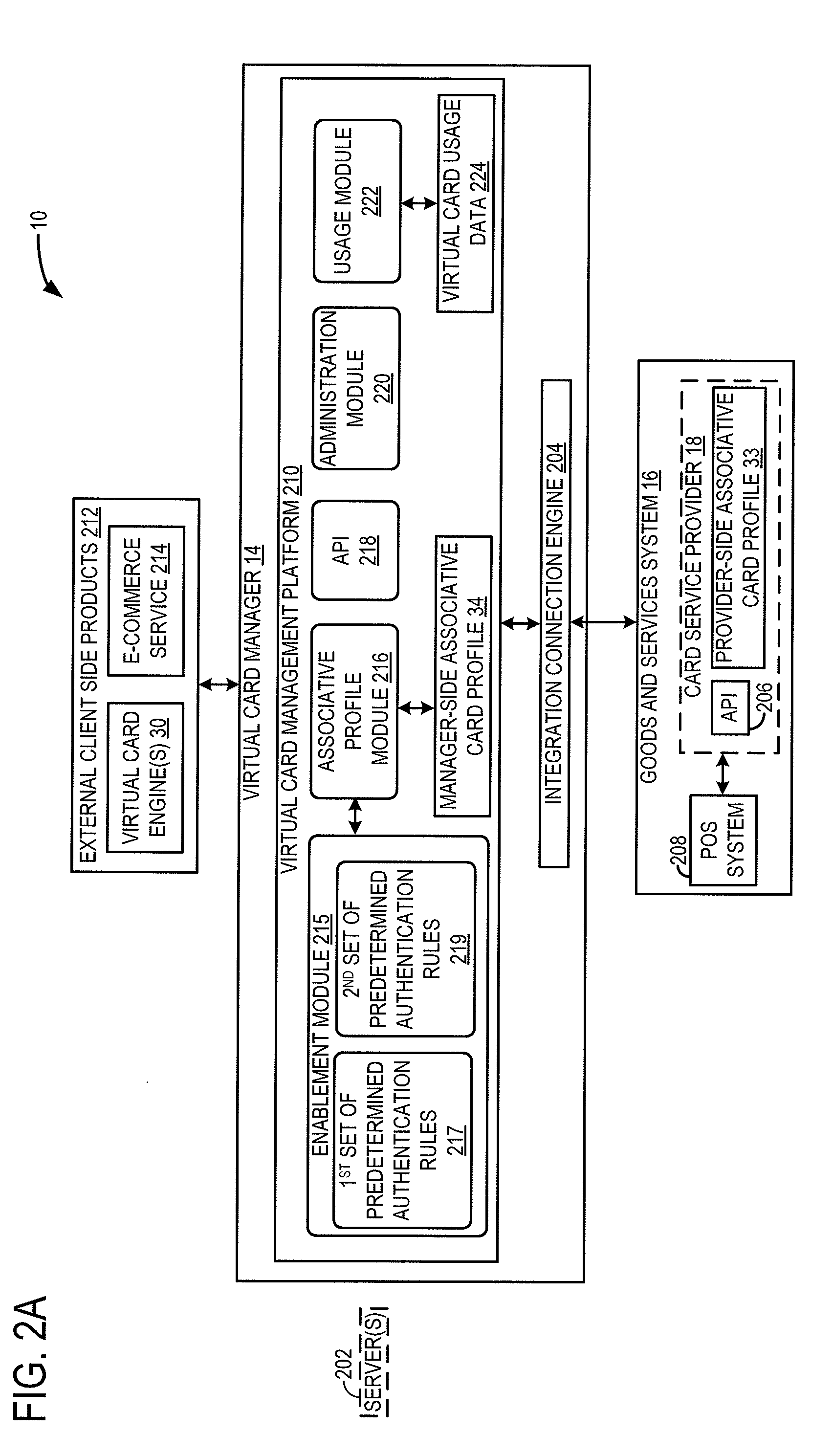

A virtual card management system including one or more servers having memory executable via a processor is provided. The virtual card management system including a virtual card manager executable on the one or more servers having an integration connector engine configured to communicatively link at least one card service provider and the virtual card manager. The virtual card management system may further include a virtual card management platform configured to communicatively link the virtual card manager with at least one virtual card engine, each virtual card engine including one or more virtual cards, the virtual card management platform including an enablement module configured to selectively enable a virtual card transaction between at least one virtual card and a corresponding card service provider based on a set of predetermined authentication rules.

Owner:E2INTERACTIVE INC D B A E2INTERACTIVE

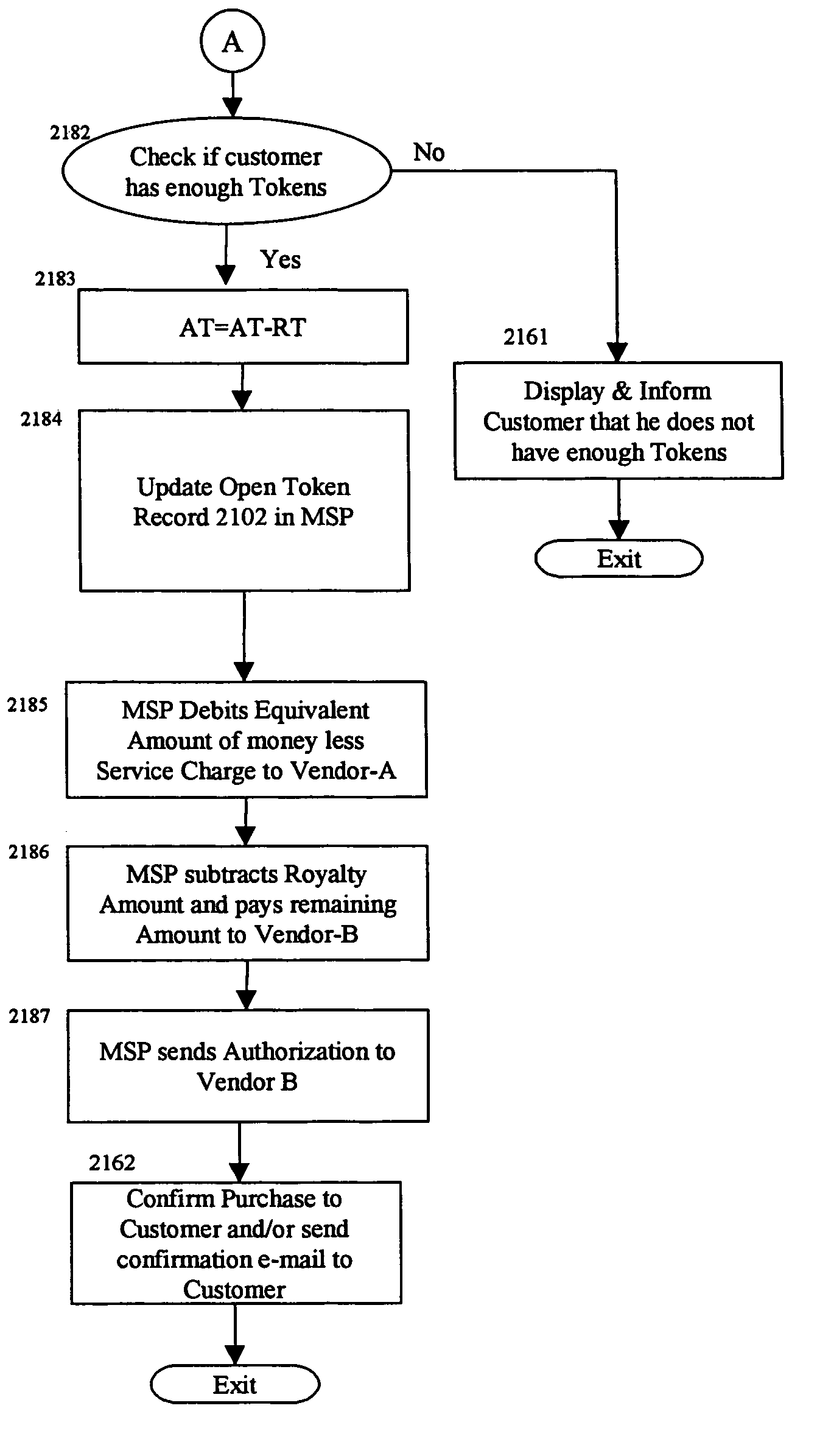

Method and apparatus for conducting electronic commerce transactions using electronic tokens

Methods and apparatus for conducting electronic commerce using electronic tokens are described. The electronic tokens are issued and maintained by a vendor, who also provides products and services that can be purchased or rented using the electronic tokens. The electronic tokens may be purchased from the vendor either on-line, using a credit card, or off-line, using a check, money order, purchase order, or other payment means. Because the vendor is the issuer of the electronic tokens, there is no need for transactions to be handled by a third party, such as a bank or other organization. This reduces the overhead involved in conducting electronic commerce, and provides the vendor with a greater amount of control. Additionally, the vendor maintains total control over the price of the electronic tokens at any time. For vendors who offer software products for sale or rental, use of electronic tokens makes a variety of rental arrangements practical. Additionally, a user registers and purchases electronic tokens at the vendor. The user may purchase products at any other vendors who conduct electronic commerce using electronic tokens.

Owner:AML IP LLC

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com