Systems and methods for banking transactions using a stored-value card

a stored-value card and banking transaction technology, applied in the field of financial services, can solve the problems of credit cards that can take weeks to issue from banks, inconvenient banking transactions, and inability to immediately withdraw funds from atm machines, so as to reduce the risks that banks take in providing banking transactions using stored-value cards, and facilitate banking transactions.

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Benefits of technology

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0020] The present inventions provide systems and methods for banking transactions using a stored-value card. Those skilled in the art will recognize that various features disclosed in connection with the embodiments may be used either individually or jointly. It is to be appreciated that while the present inventions have been described with reference to preferred implementations, those having ordinary skill in the art will recognize that the present inventions may be beneficially utilized in any number of environments and implementations.

[0021] The inventions have been described below with reference to specific embodiments. It will be apparent to those skilled in the art that various modifications may be made and other embodiments can be used without departing from the broader scope of the inventions. Therefore, these and other variations upon the specific embodiments are intended to be covered by the present inventions.

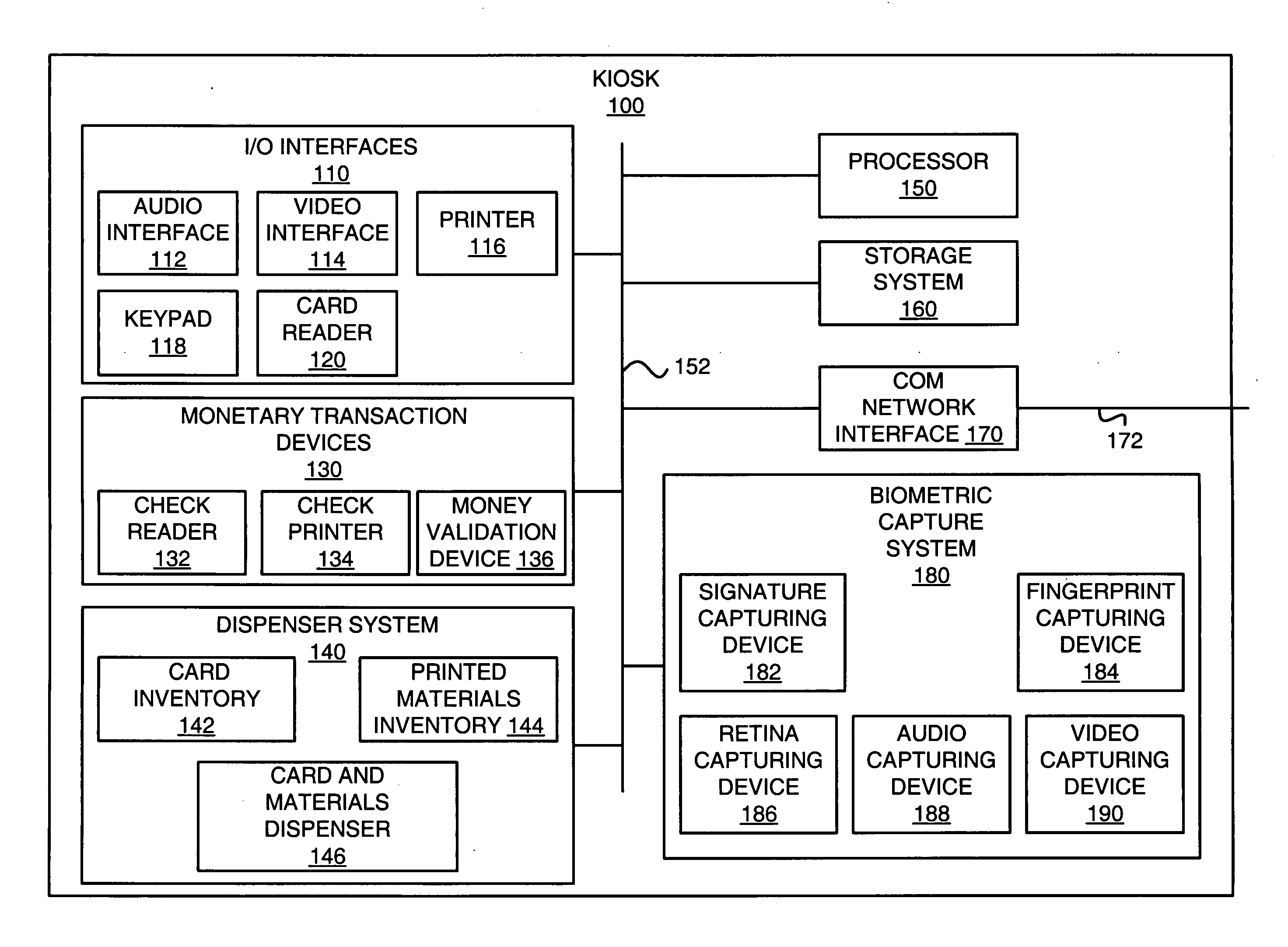

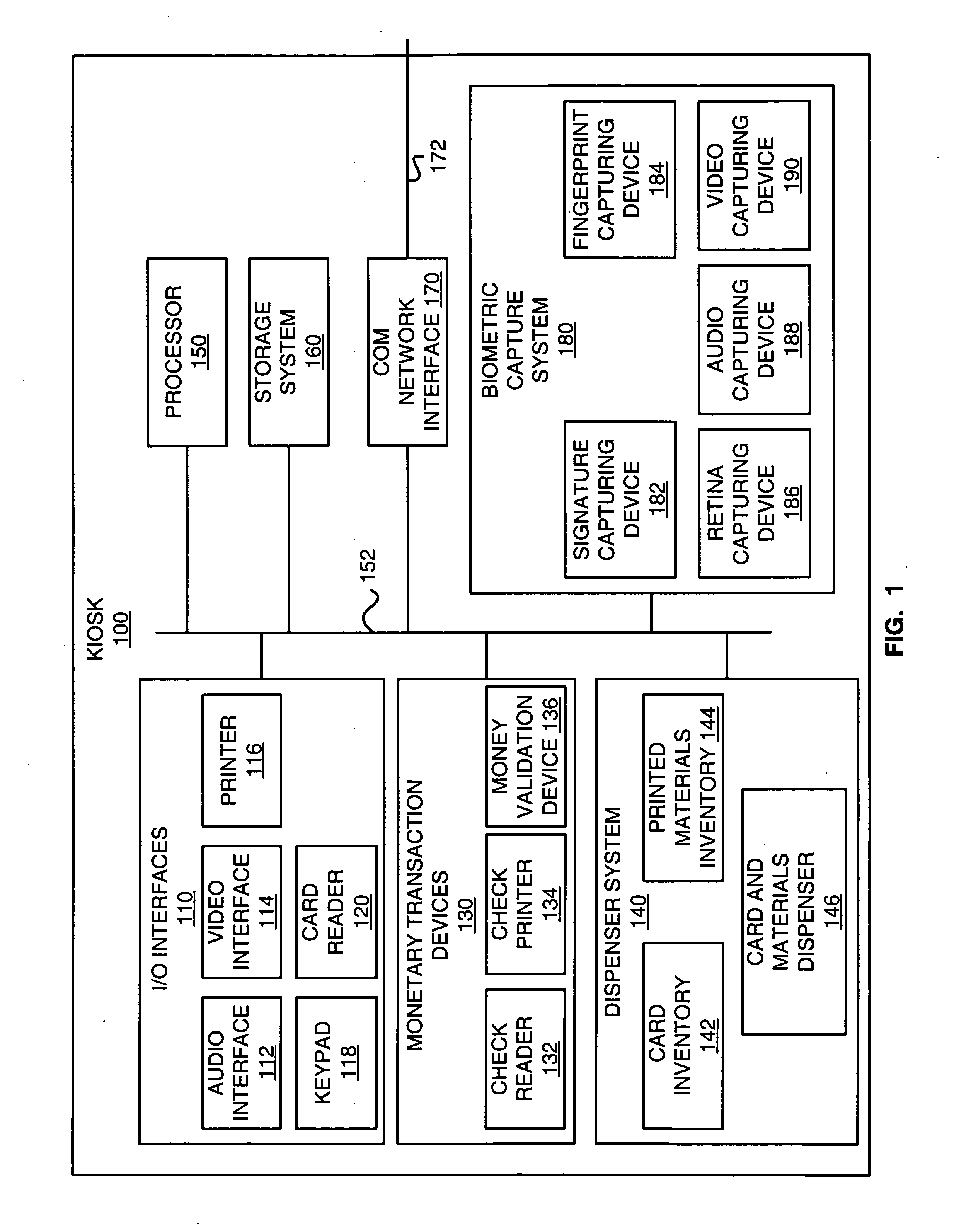

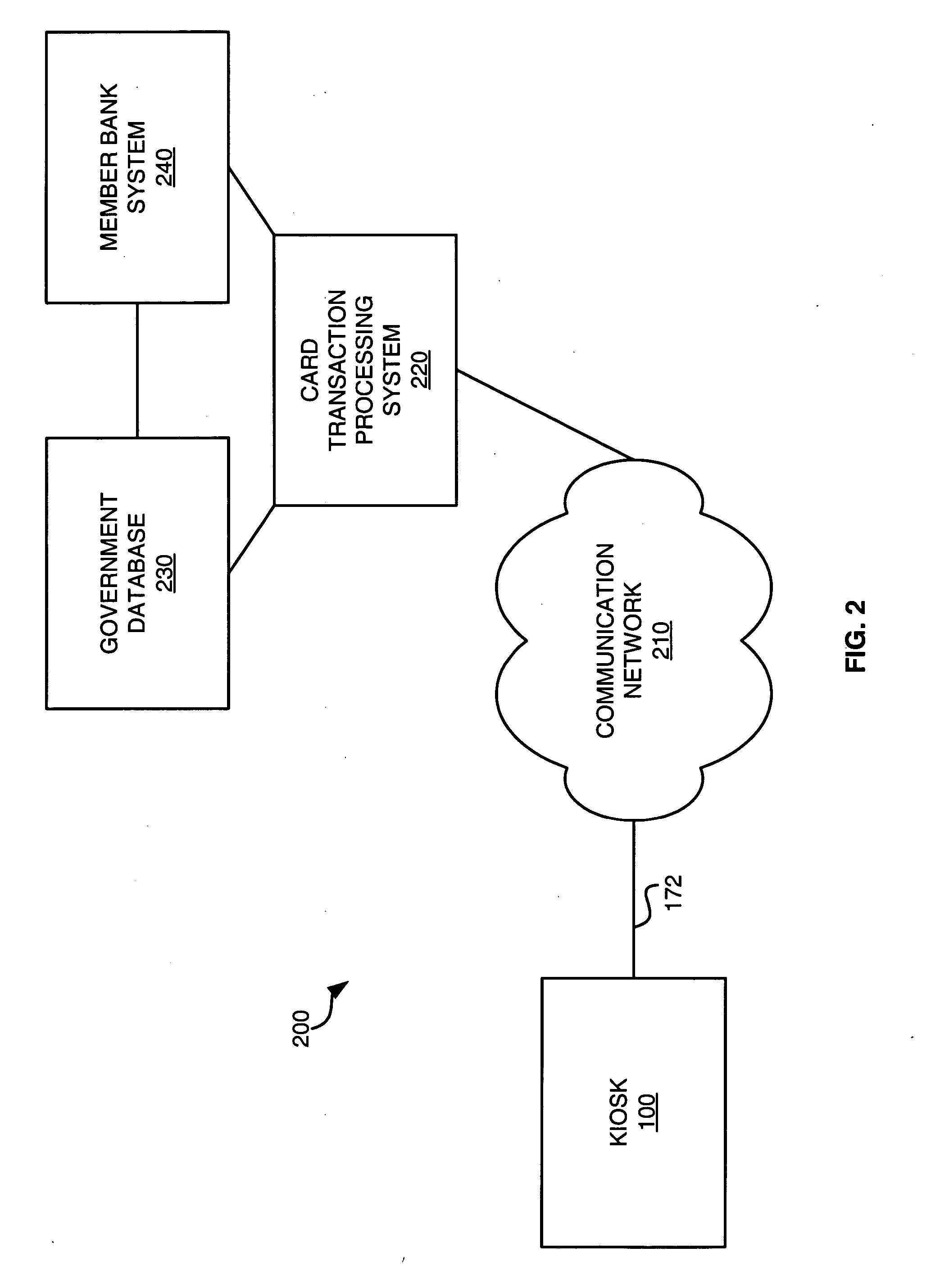

[0022] The systems and methods for banking transactions use ...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com