Patents

Literature

1990results about "Automatic teller machines" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

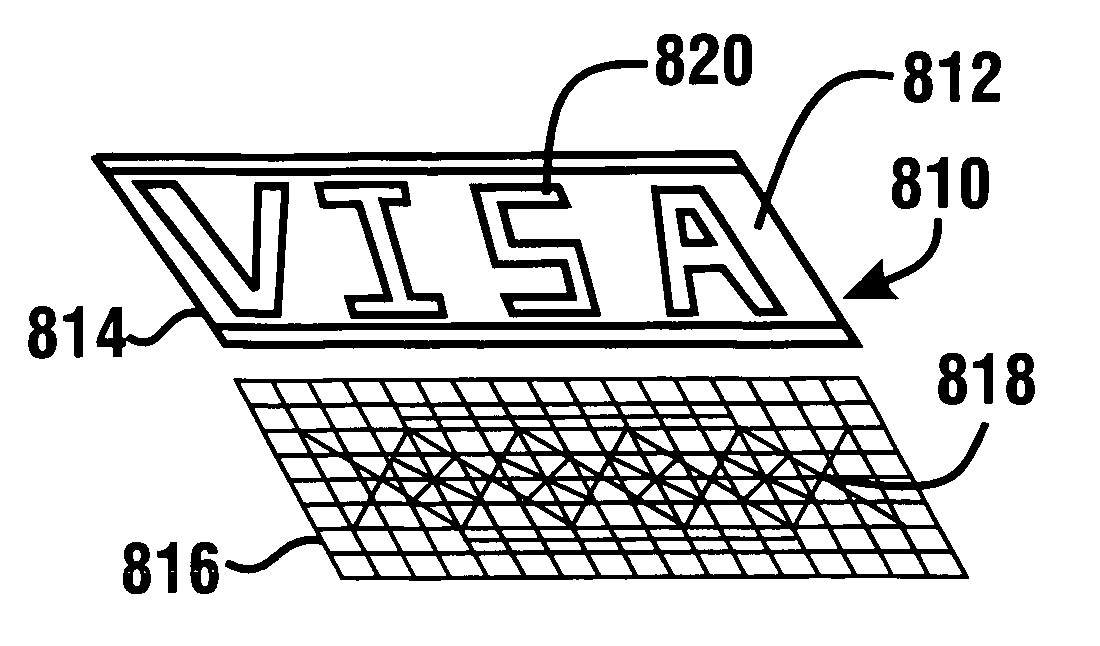

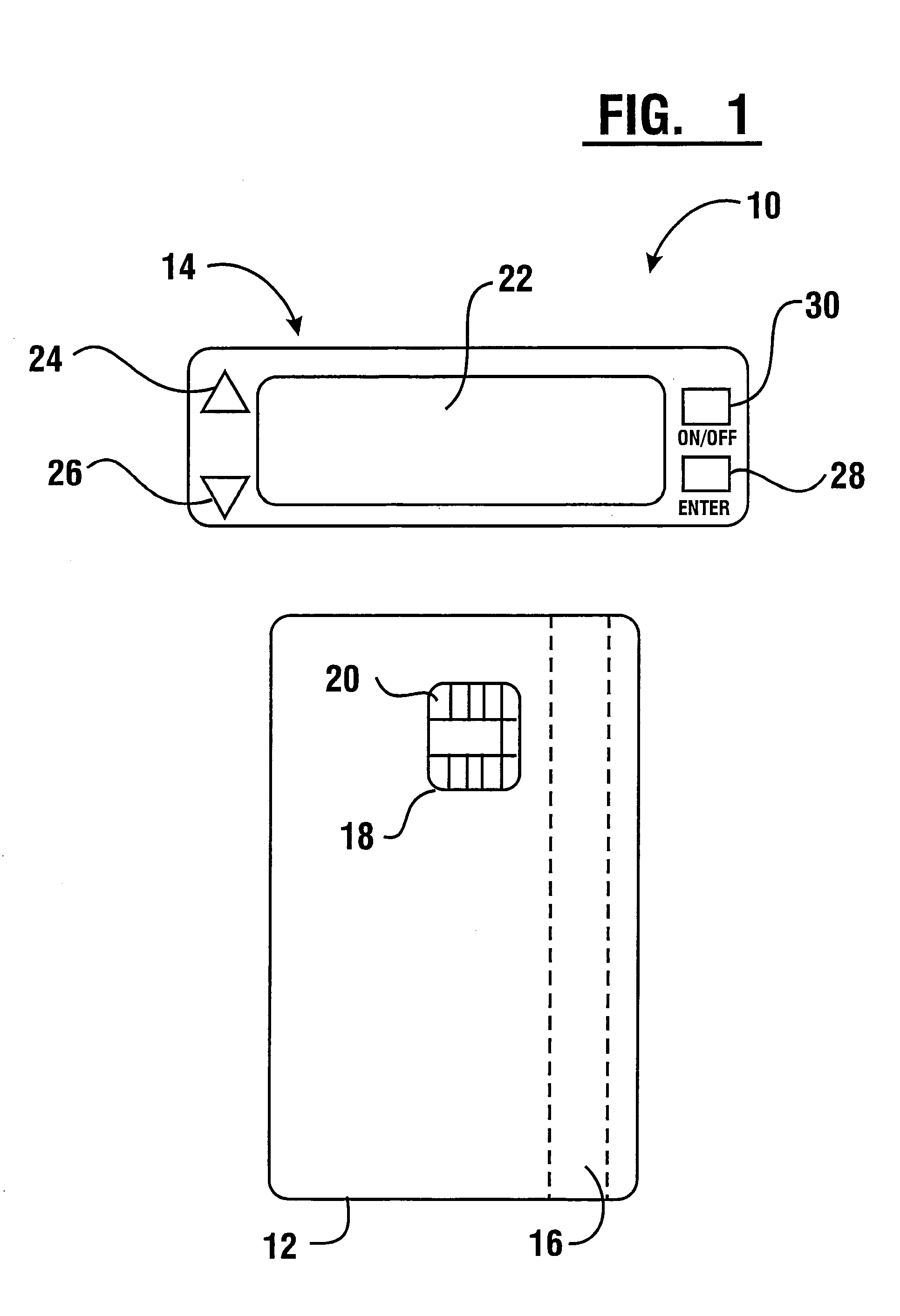

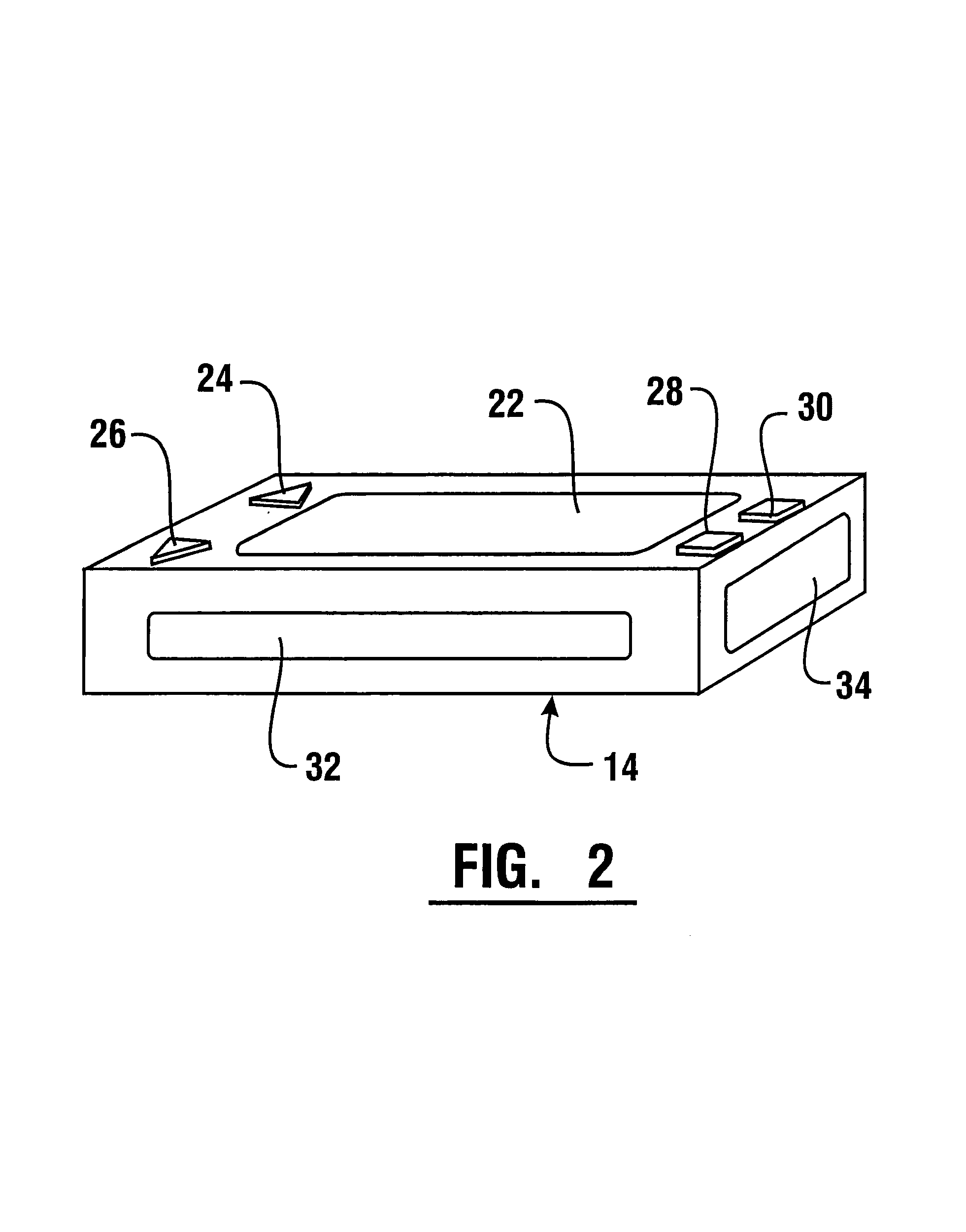

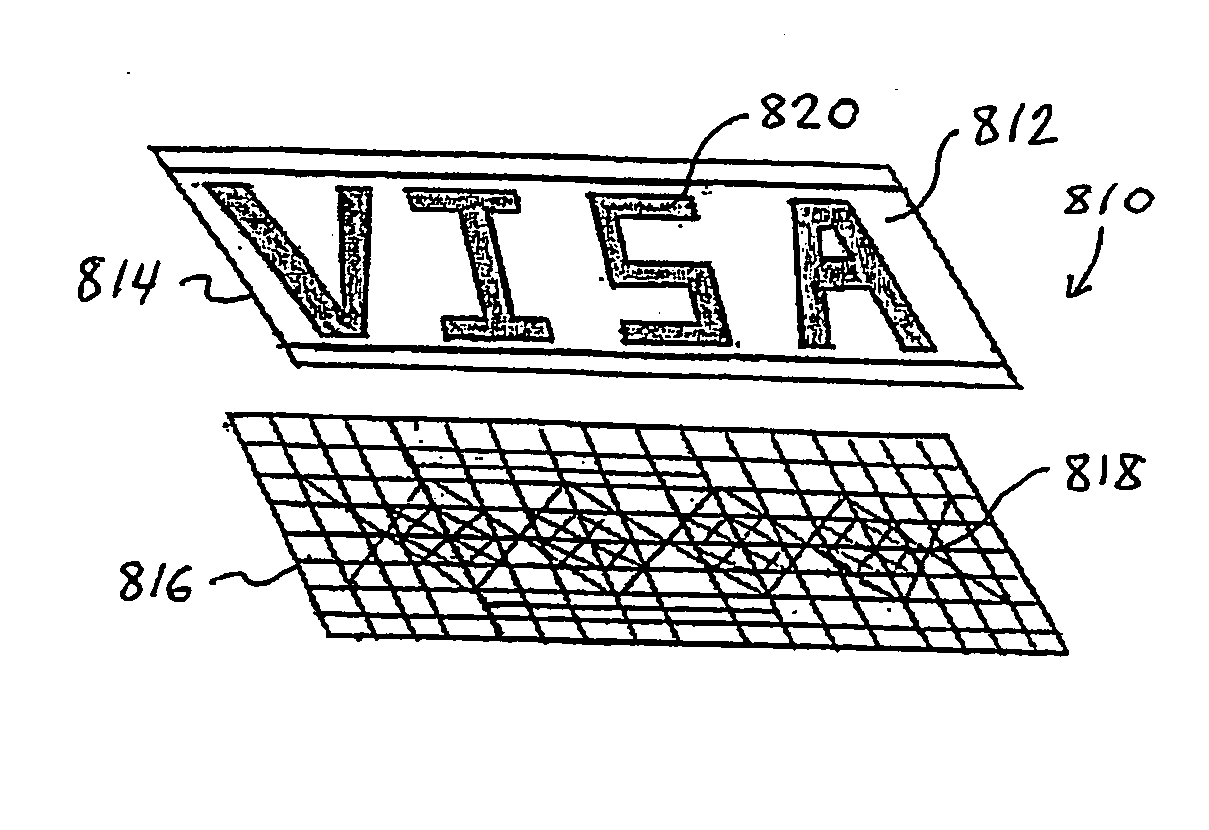

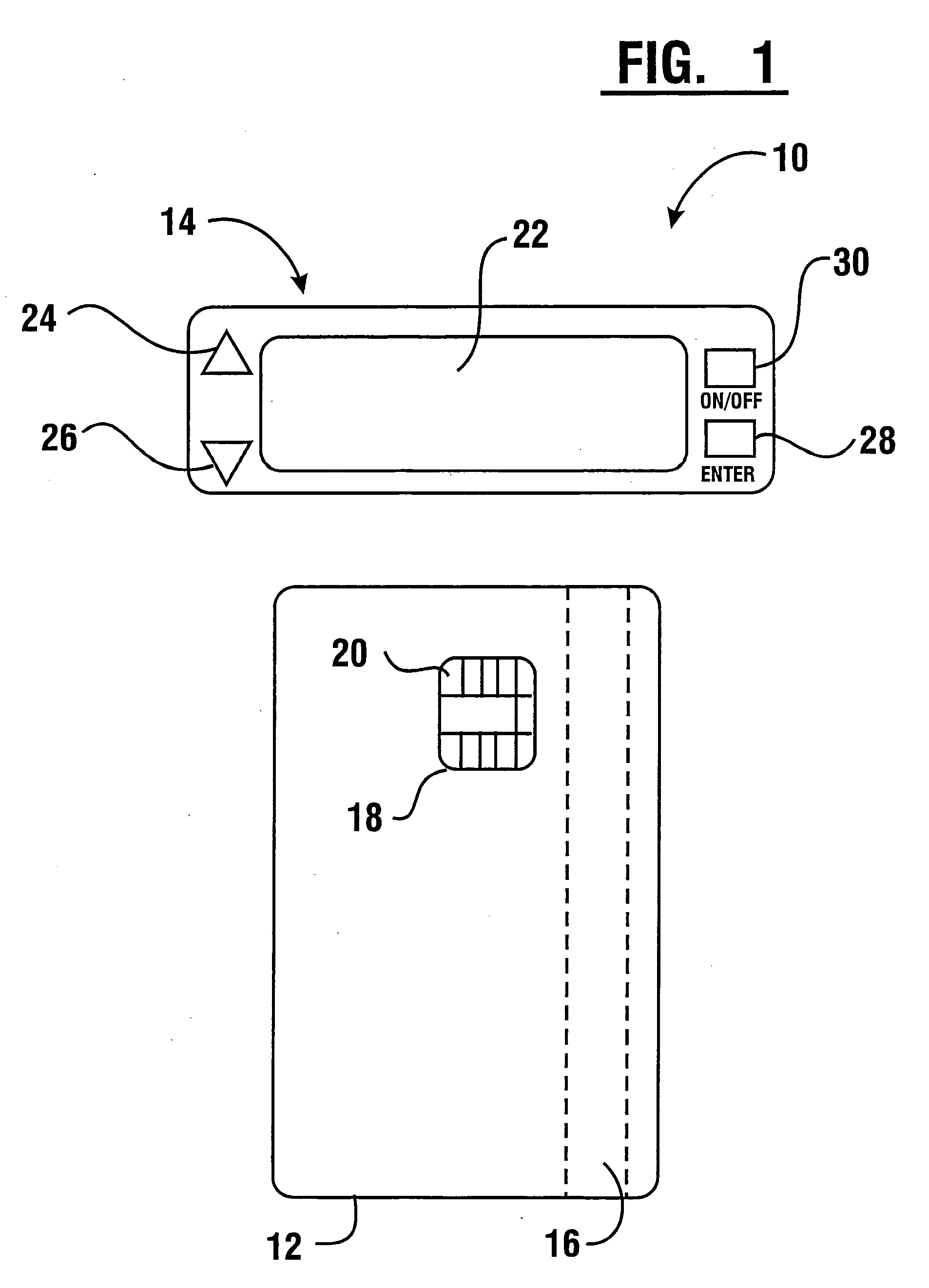

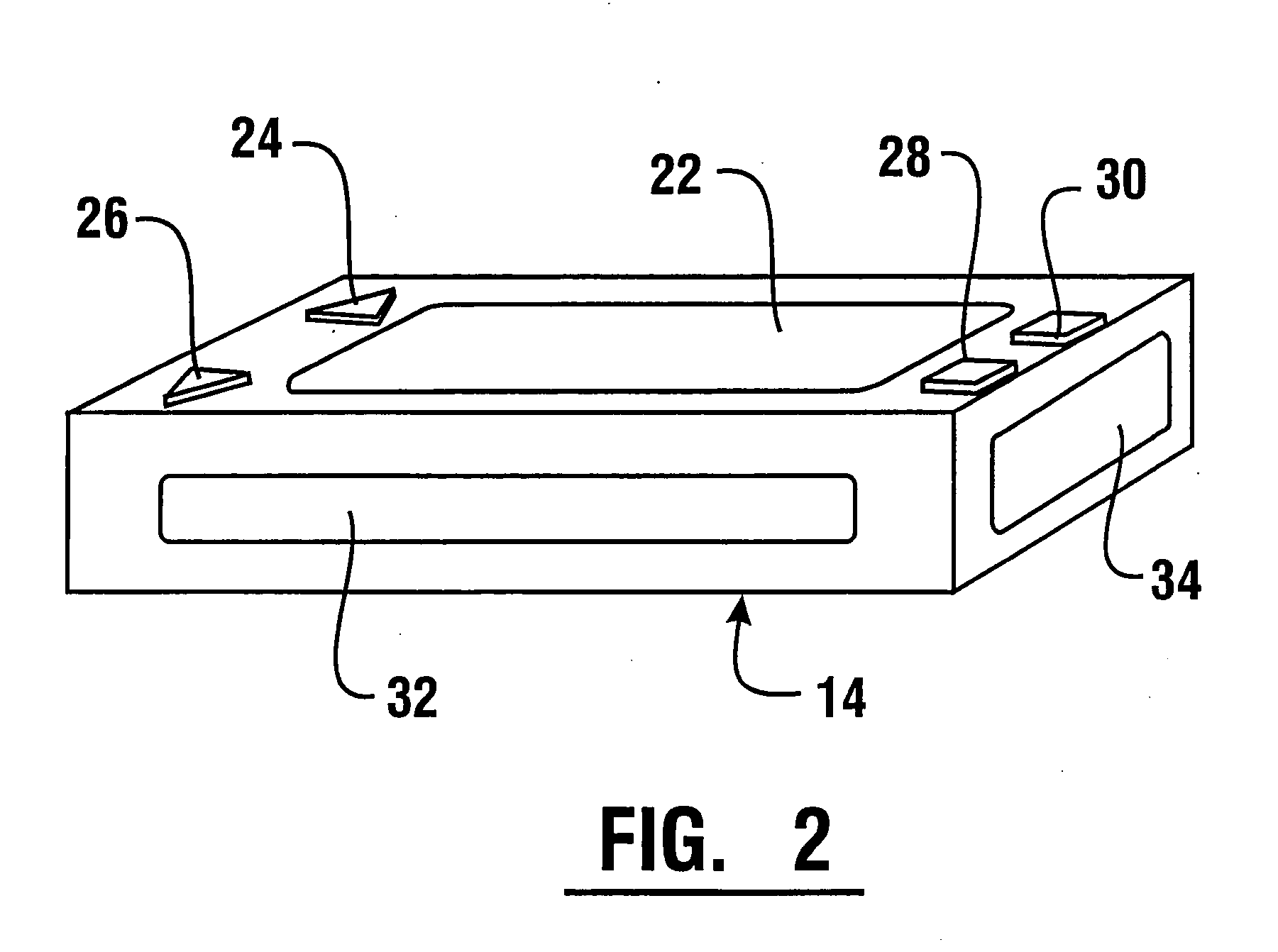

Multi-account card with magnetic stripe data and electronic ink display being changeable to correspond to a selected account

A multifunction card includes a programmable memory, a magnetic stripe, and an electronic ink display. The programmable memory is able to store corresponding account data and image data for a plurality of different accounts. The card holder is able to use a portable terminal to select one of the accounts stored in memory. The terminal is able to write account data corresponding to the selected account to the magnetic stripe of the card. The terminal is also able to electronically change the electronic ink display to the image corresponding to the selected account. Thus, a single multifunction card, with the ability to have both its magnetic stripe data and appearance changed in accordance with a selected account, can substitute for many different cards.

Owner:DIEBOLD SELF SERVICE SYST DIV OF DIEBOLD NIXDORF INC

Wireless electronic check deposit scanning and cashing machine with web-based online account cash management computer application system

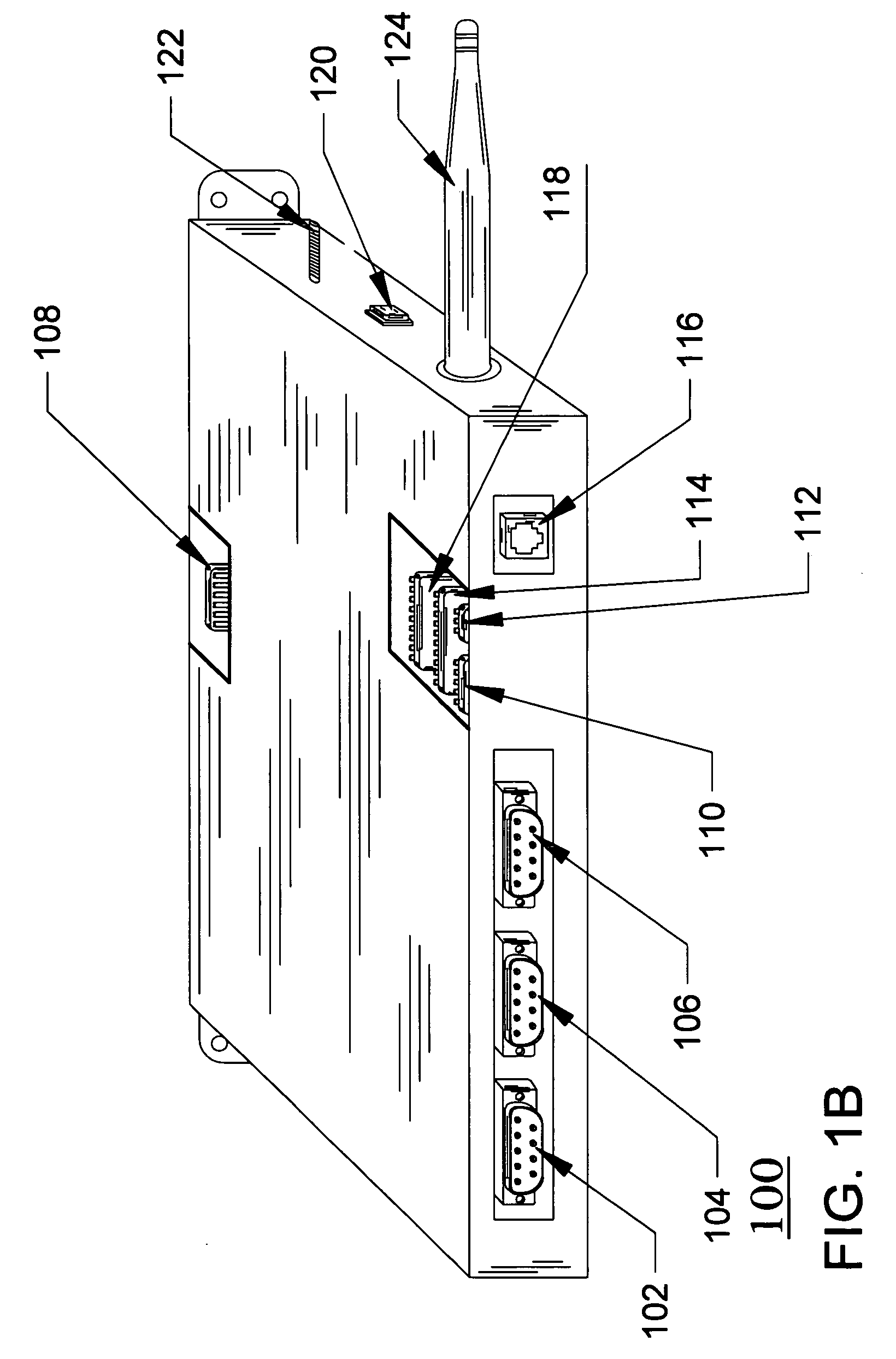

Wireless Electronic Check Deposit Scanning and Cashing Machine (also known and referred to as WEDS) Web-based Online account cash Management computer application System (also known and referred to as OMS virtual / live teller)—collectively invented integrated as “WEDS.OMS” System. Method and Apparatus for Depositing and Cashing Ordinary paper and / or substitute checks and money orders online Wirelessly from home / office computer, laptop, Internet enabled mobile phone, pda (personal digital assistant) and / or any Internet enabled device. WEDS enables verification and transmittal of image, OMS is the navigation tool used to set commands and process requests, integrated with WEDS, working collectively as WEDS.OMS System.

Owner:USAA

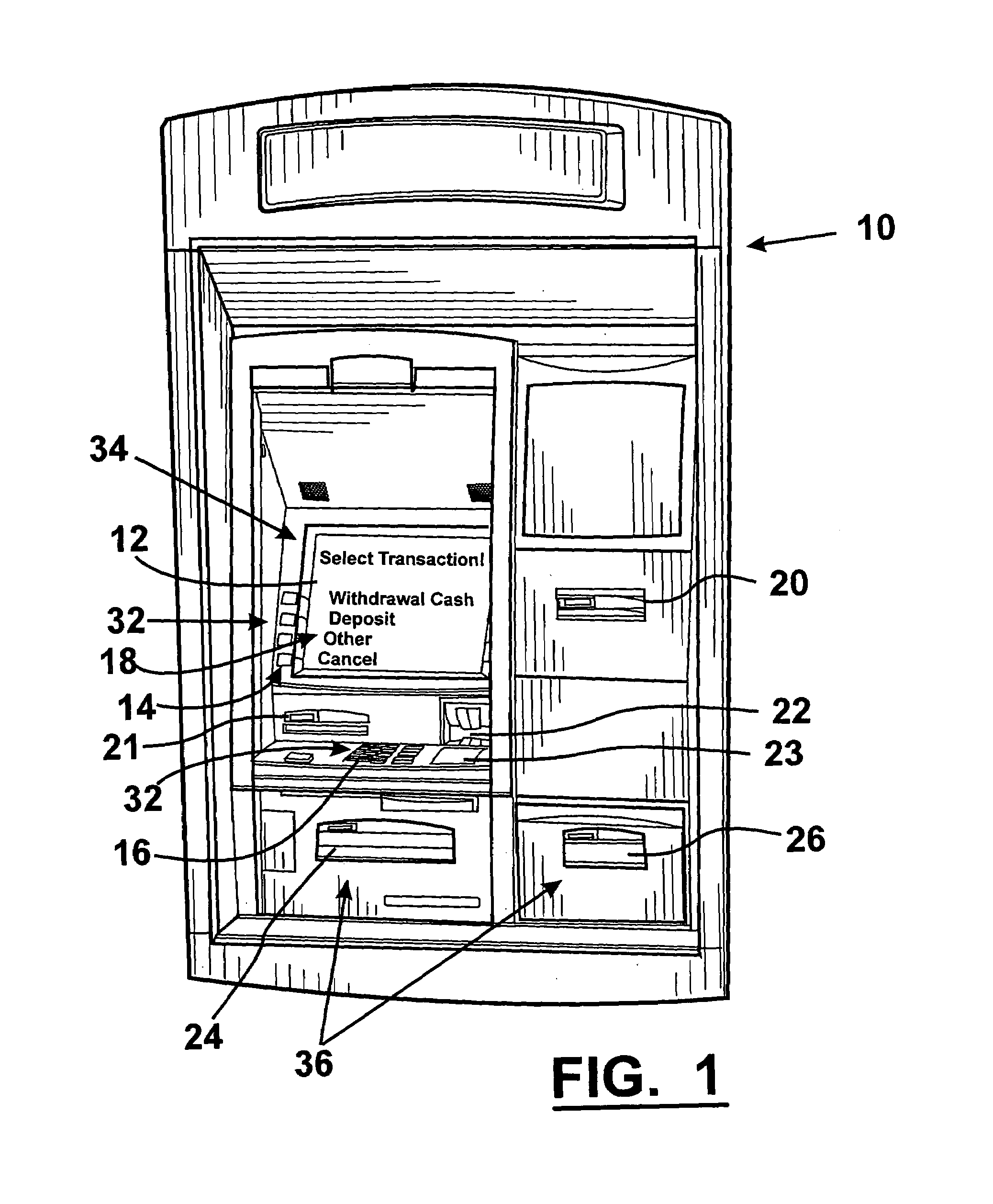

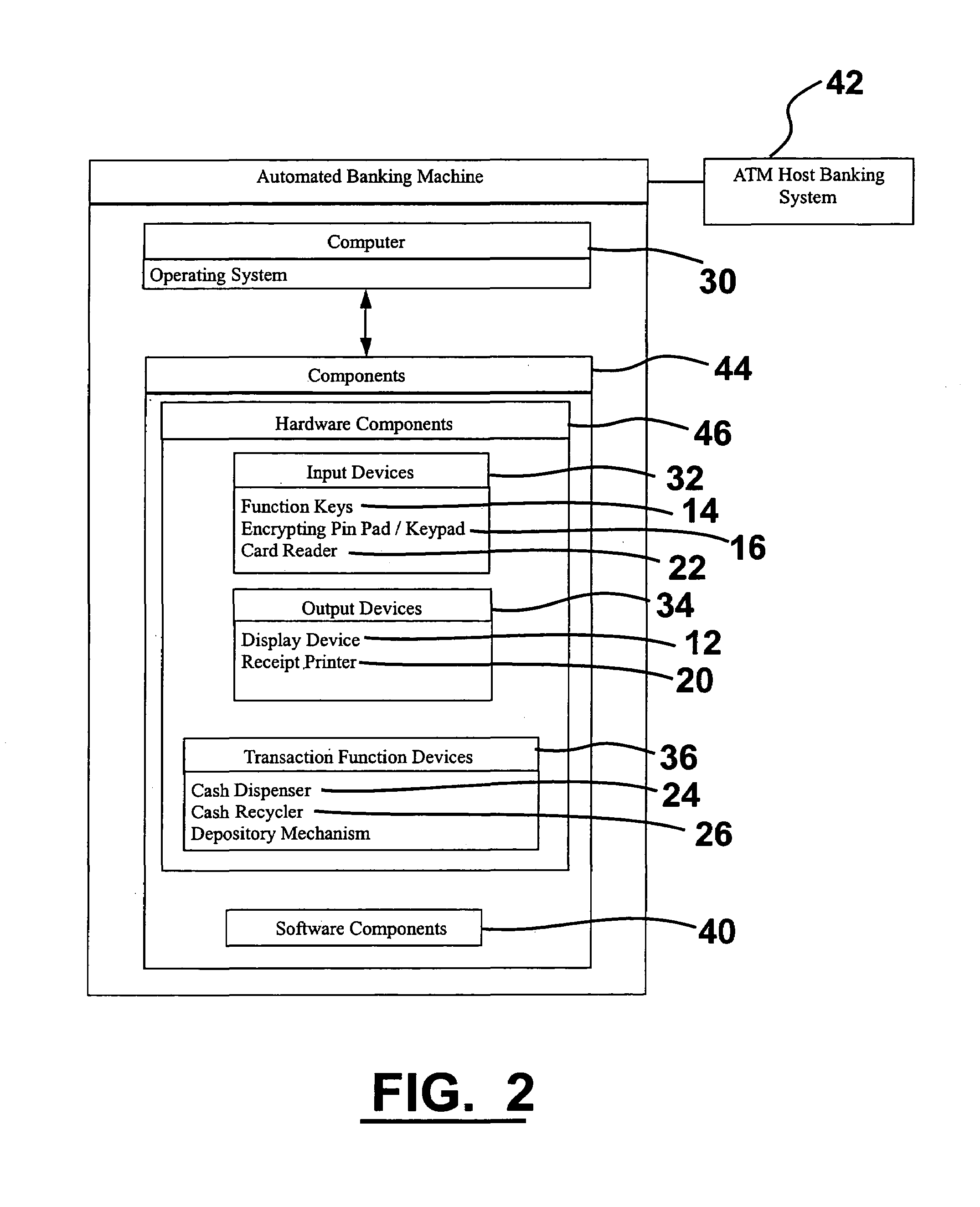

Automated banking machine system and method

InactiveUS20030217005A1Good user interfaceFunction increaseBuying/selling/leasing transactionsSpecific program execution arrangementsEmail addressCheque

A system and method of providing an electronic transaction receipt from a cash dispensing ATM. A bank host computer is operable to submit the receipt to a system address of record with the bank. The address of record corresponds to an e-mail address, phone number or other address associated with an account involved in the transaction. The receipt may include an image or images associated with the transaction. Thus, a user of an ATM is able to receive an electronic receipt corresponding to the ATM transaction. The system may also operate to image deposited checks deposited at an ATM. Copies of the imaged checks and other information can be electronically sent to a maker, payee, a clearinghouse or banks involved with the transaction. The system may also operate to provide the user with blank checks in hard copy or virtual checks for transactions.

Owner:DIEBOLD NIXDORF

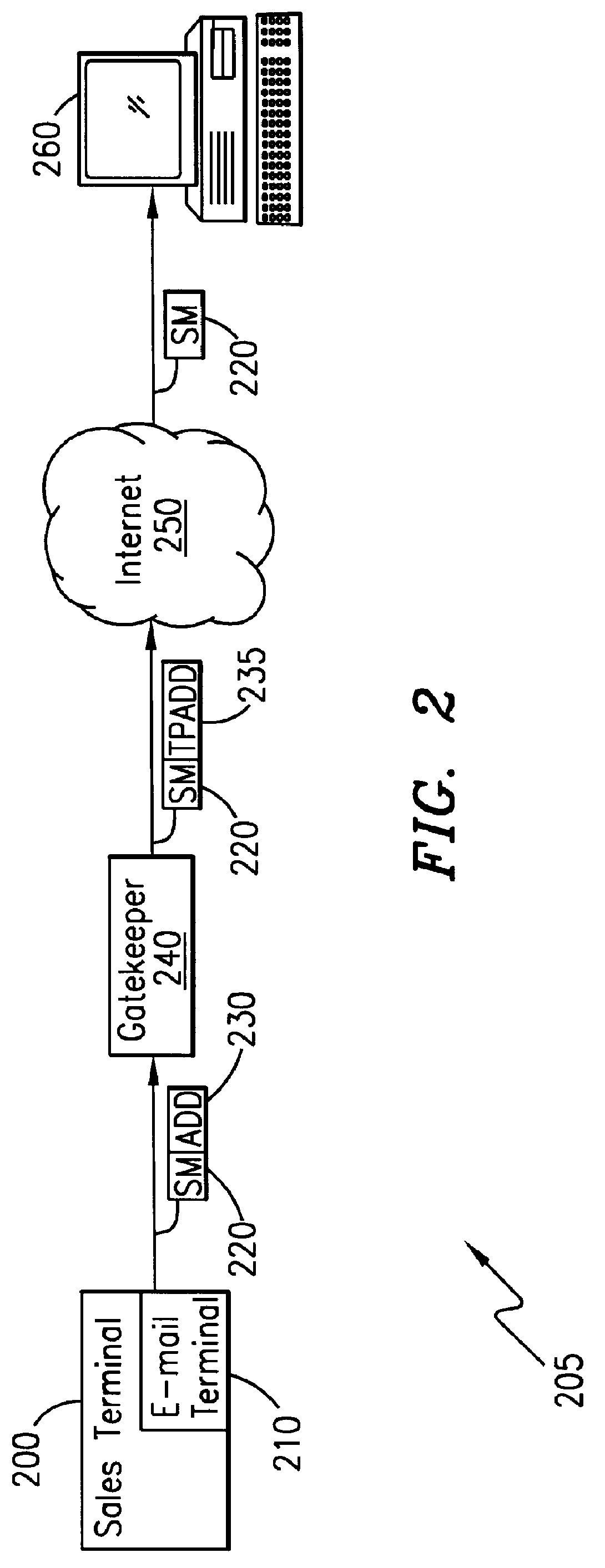

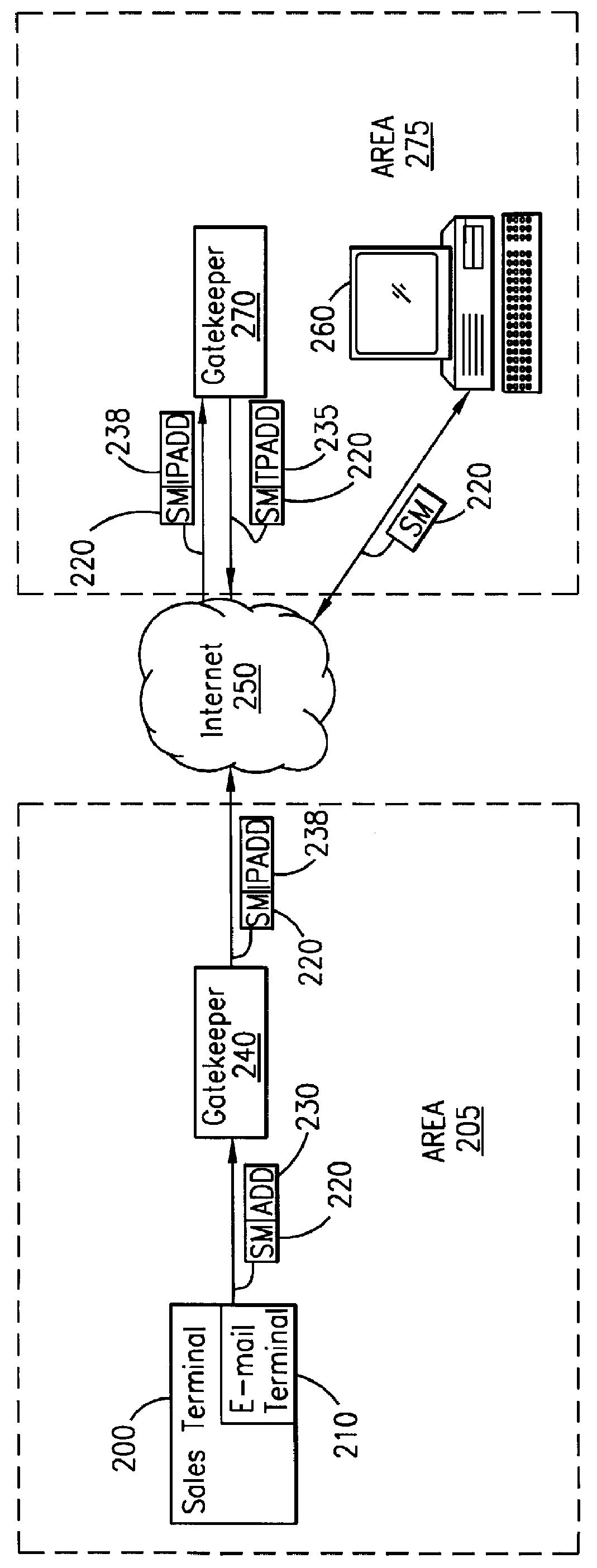

System and method for sending a short message containing purchase information to a destination terminal

InactiveUS6067529AEfficient and cost-effectiveReliable deliveryComplete banking machinesCash registersMulticast addressComputer terminal

A telecommunications system and method is disclosed for providing a substantially immediate electronic receipt after a consumer has made a purchase. When a consumer makes a purchase, the sales terminal, which is attached with a short message / e-mail sending capable terminal, can generate and route a short message along with the detailed purchase information to a transport address or alias address associated with the consumer via a Gatekeeper for the Internet for the area that the sales terminal is located in. Upon receipt of the short message, the Gatekeeper can then convert the alias address to the transport address, if the alias address is given and the consumer does not want the short message sent to the alias address, and forward the short message through the Internet to that transport address (or alias address) as an Internet Protocol datagram for storage and retrieval of the short message by the consumer either immediately or at a later time.

Owner:ERICSSON INC

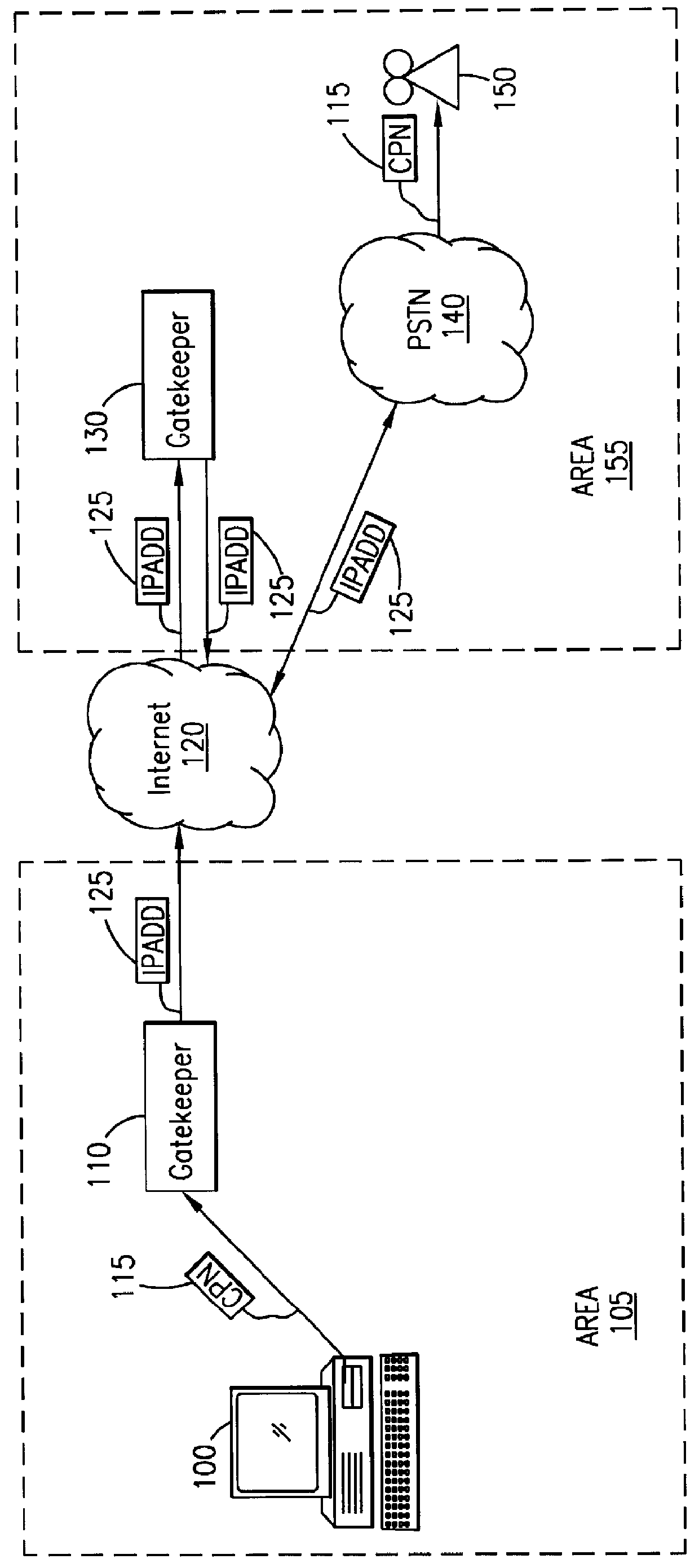

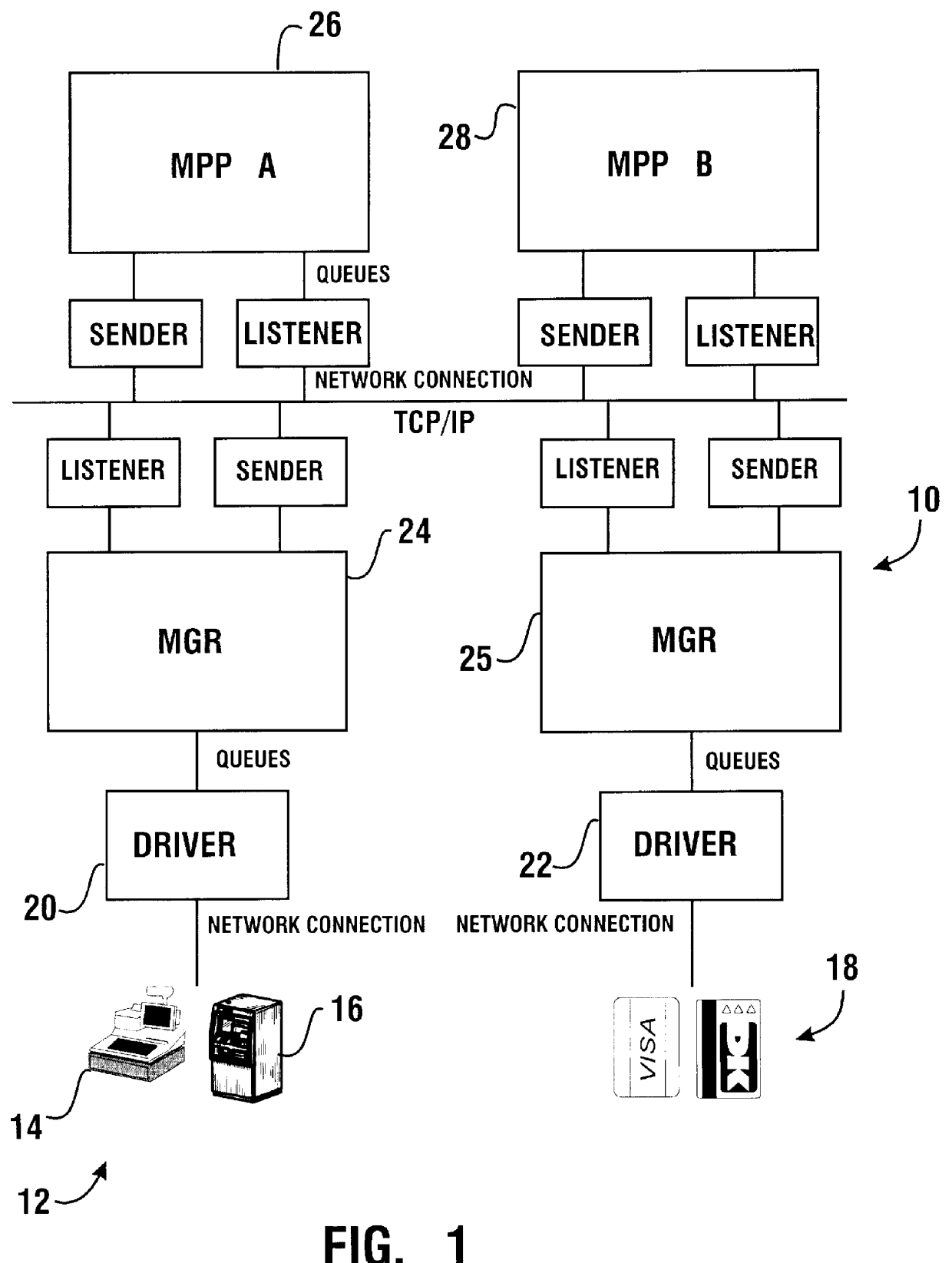

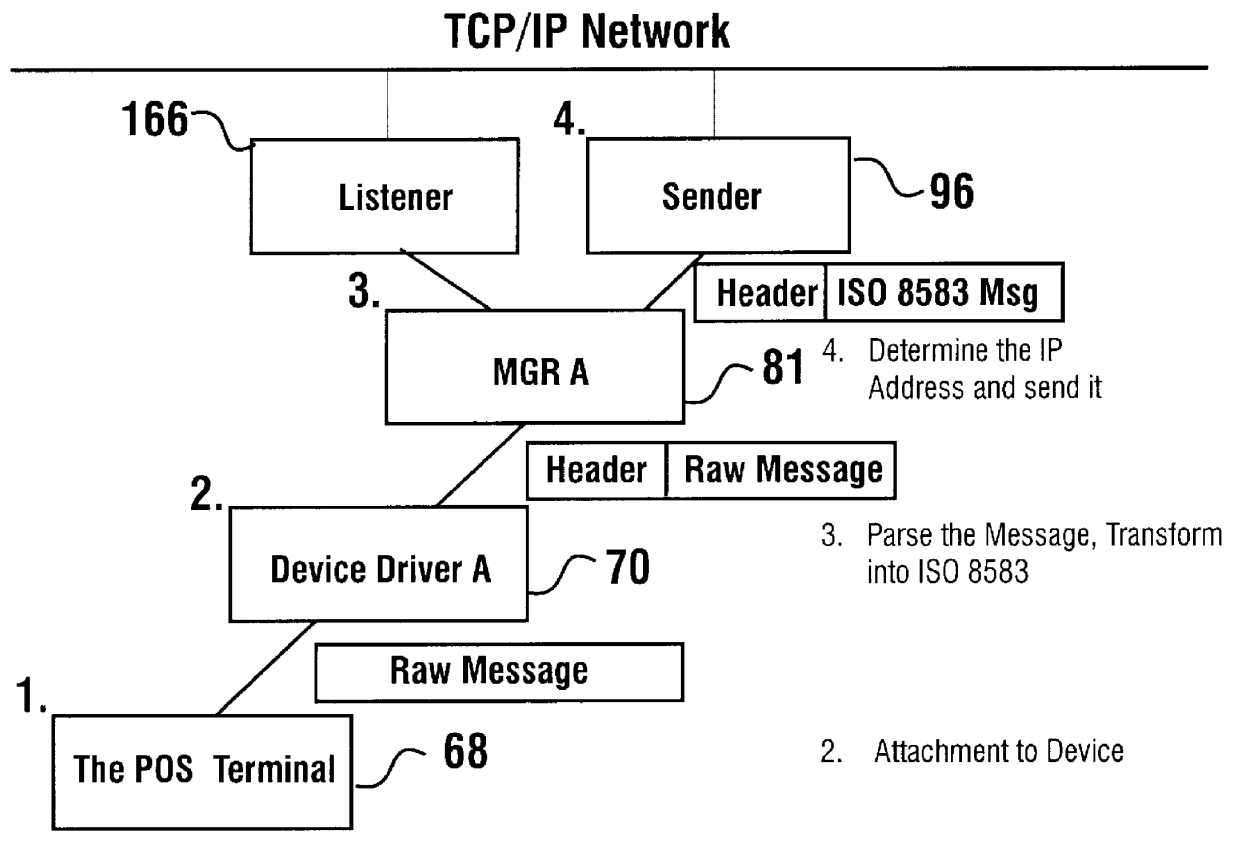

System and method for performing money transfer transaction using TCP/IP

InactiveUS6502747B1Low costShorten the timeComplete banking machinesFinanceInternet protocol suiteProtocol for Carrying Authentication for Network Access

A method of performing a money transfer transaction through a financial services institution includes receiving information regarding the transaction on a first computer of the financial services institution from a first electronic device using the Transmission Control Protocol / Internet Protocol suite (TCP / IP). The method may also include establishing a T1 connection between the first computer and the first electronic device. A system for performing a money transfer transaction using TCP / IP is also disclosed.

Owner:THE WESTERN UNION CO

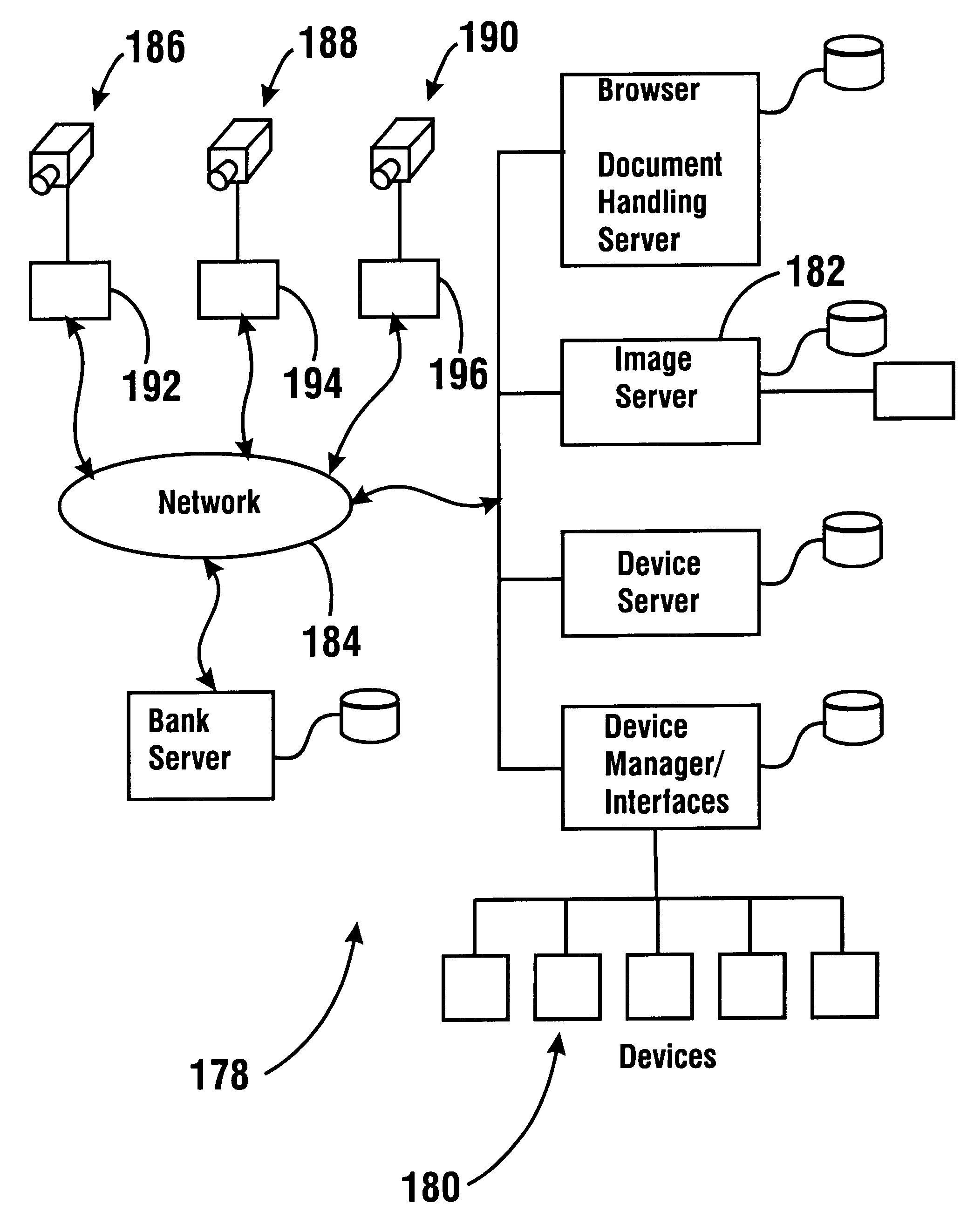

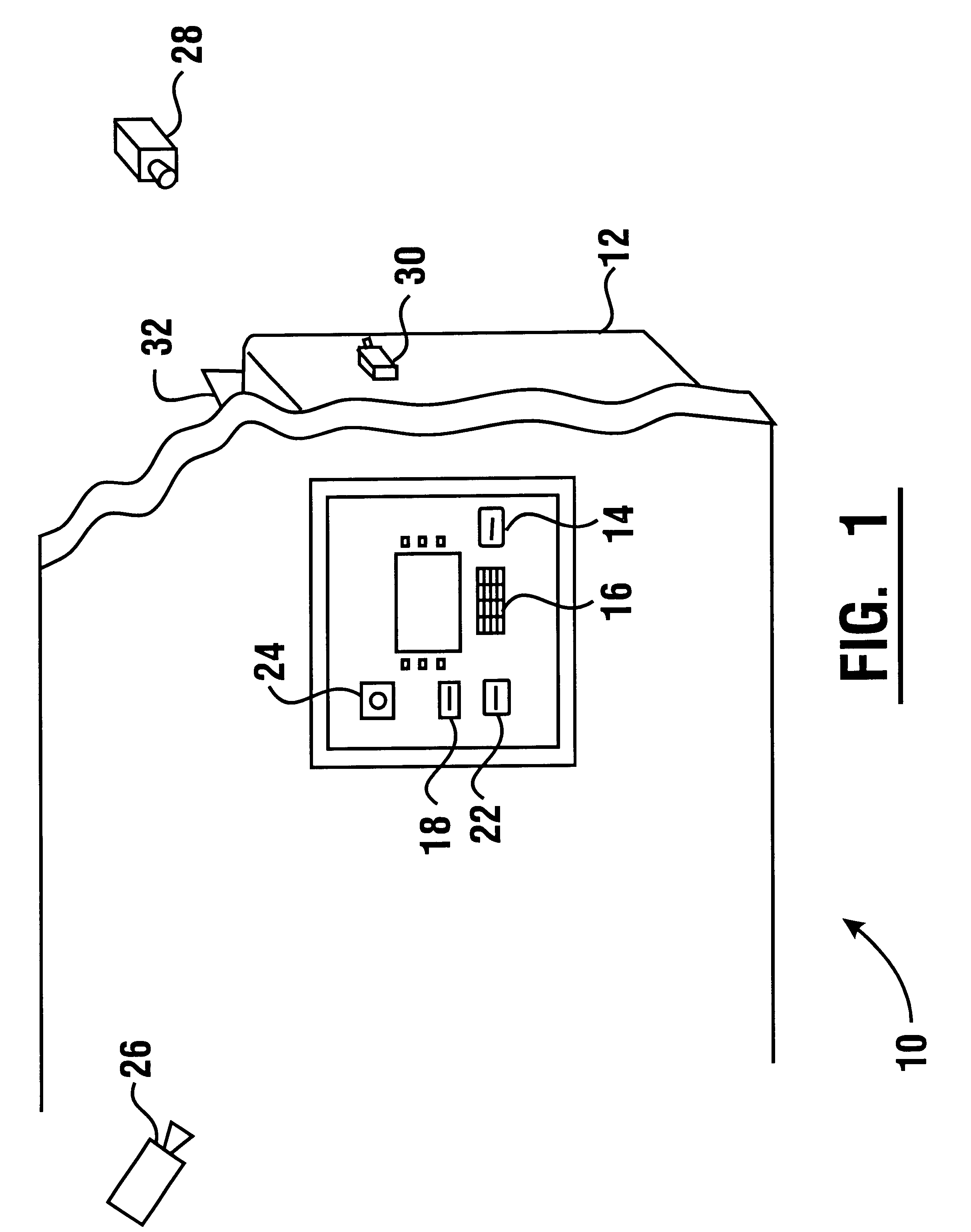

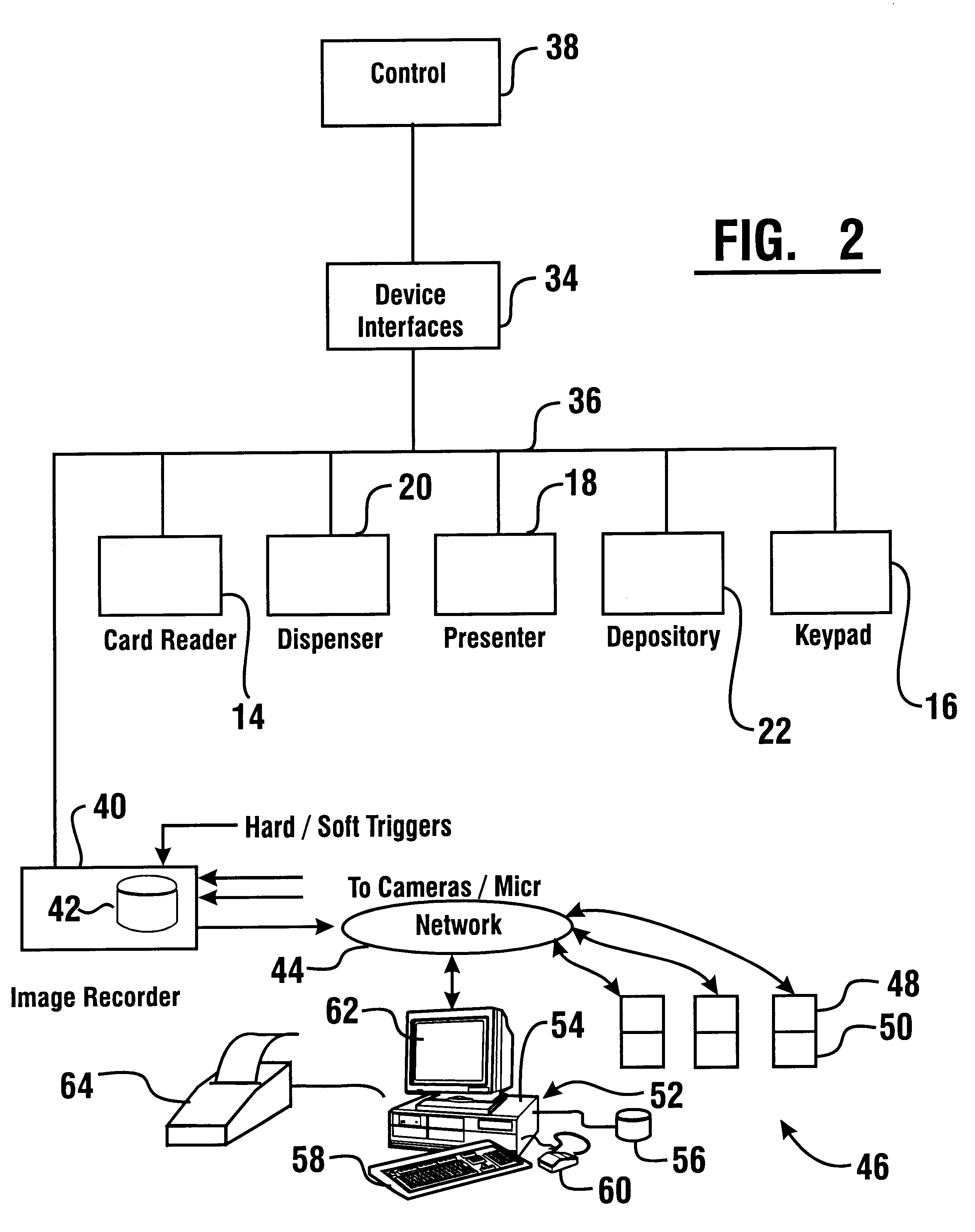

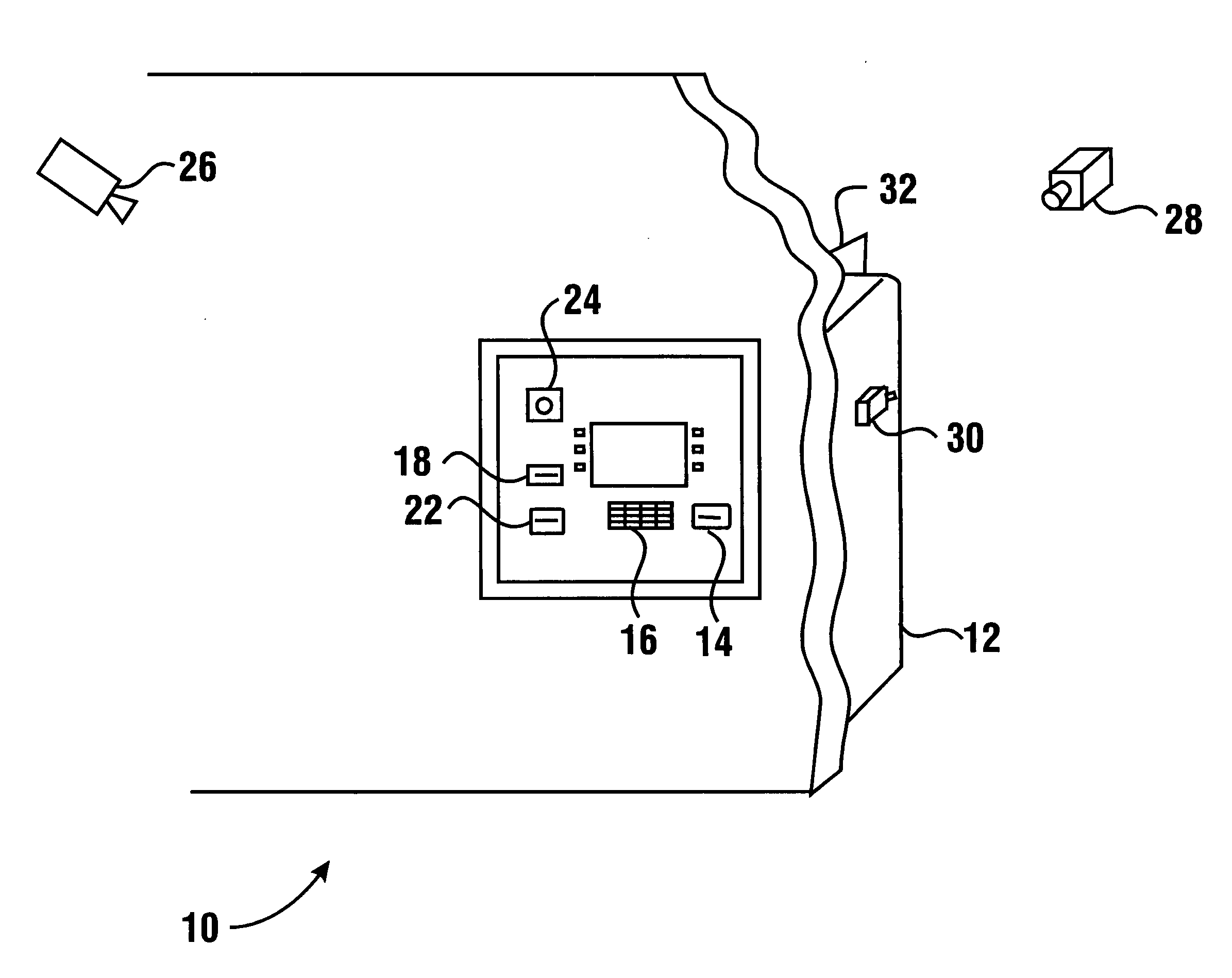

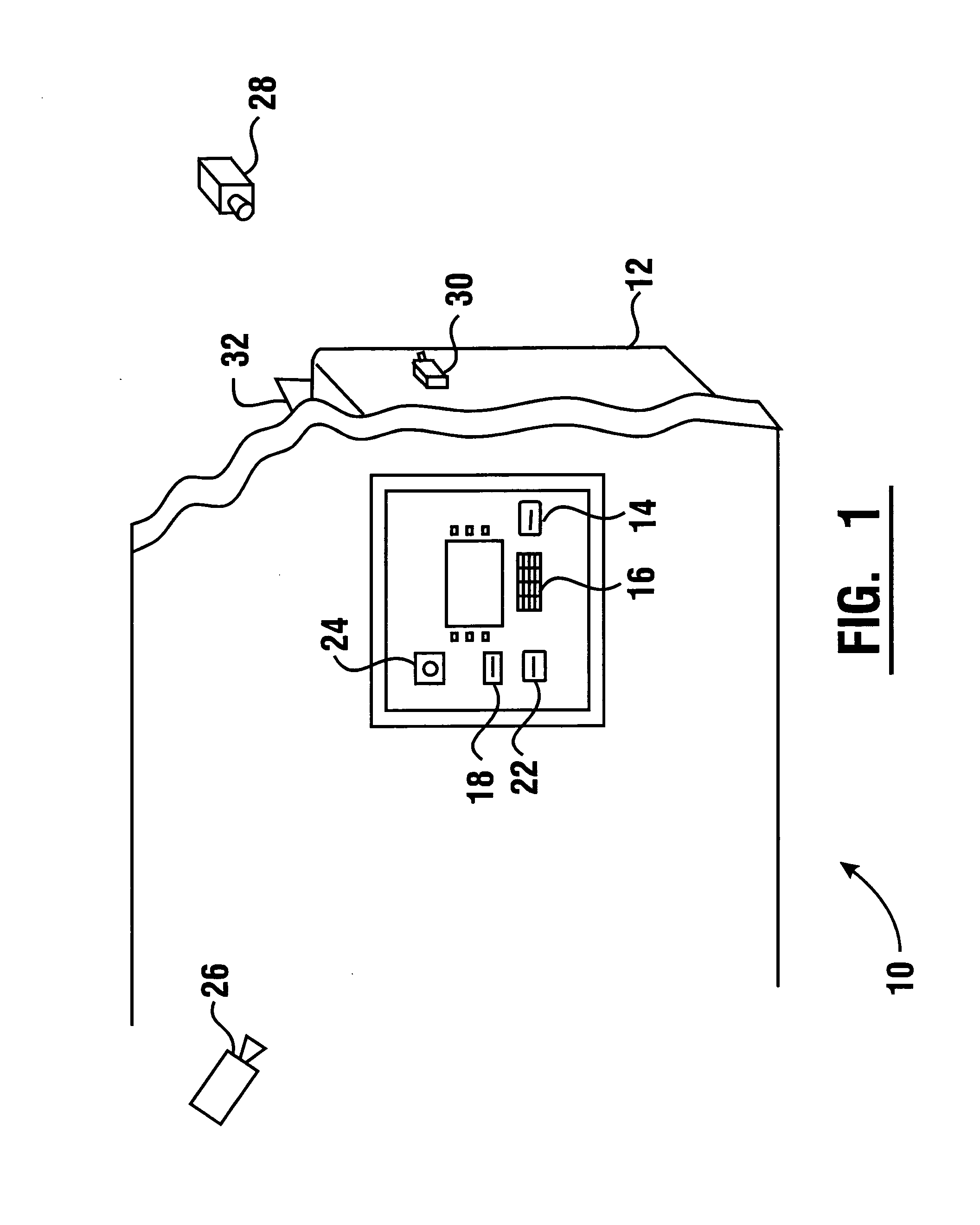

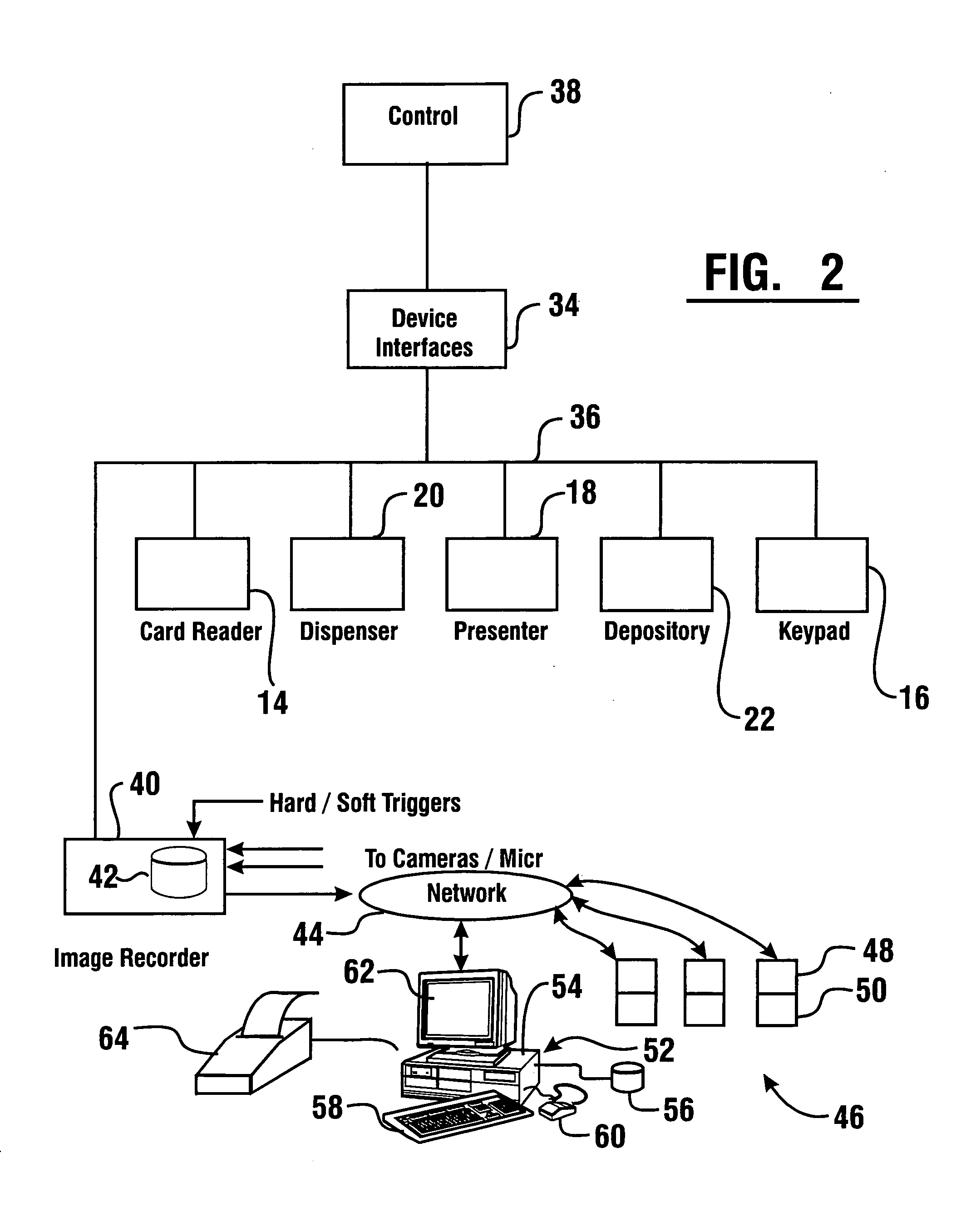

System and method for capturing and searching image data associated with transactions

InactiveUS6583813B1Programmed more readilyEasy programmingComplete banking machinesColor television detailsImaging conditionEvent type

A system and method for capturing image data captures images responsive to programmed sequences. The sequences are performed on a periodic basis as well as in response to inputs corresponding to alarm conditions and transactions conducted at automated banking machines or other devices. Image data may also be captured in response to image conditions including the sensing of motion or the loss of usable video from selected cameras. Image data is stored in connection with data corresponding to circumstances associated with each triggering event. Stored image data may be searched by one or more parameters. Parameters include data stored in association with each image, types of events causing image data to be stored, as well as other image conditions in stored images.

Owner:SECURITAS ELECTRONICS SECURITY INC

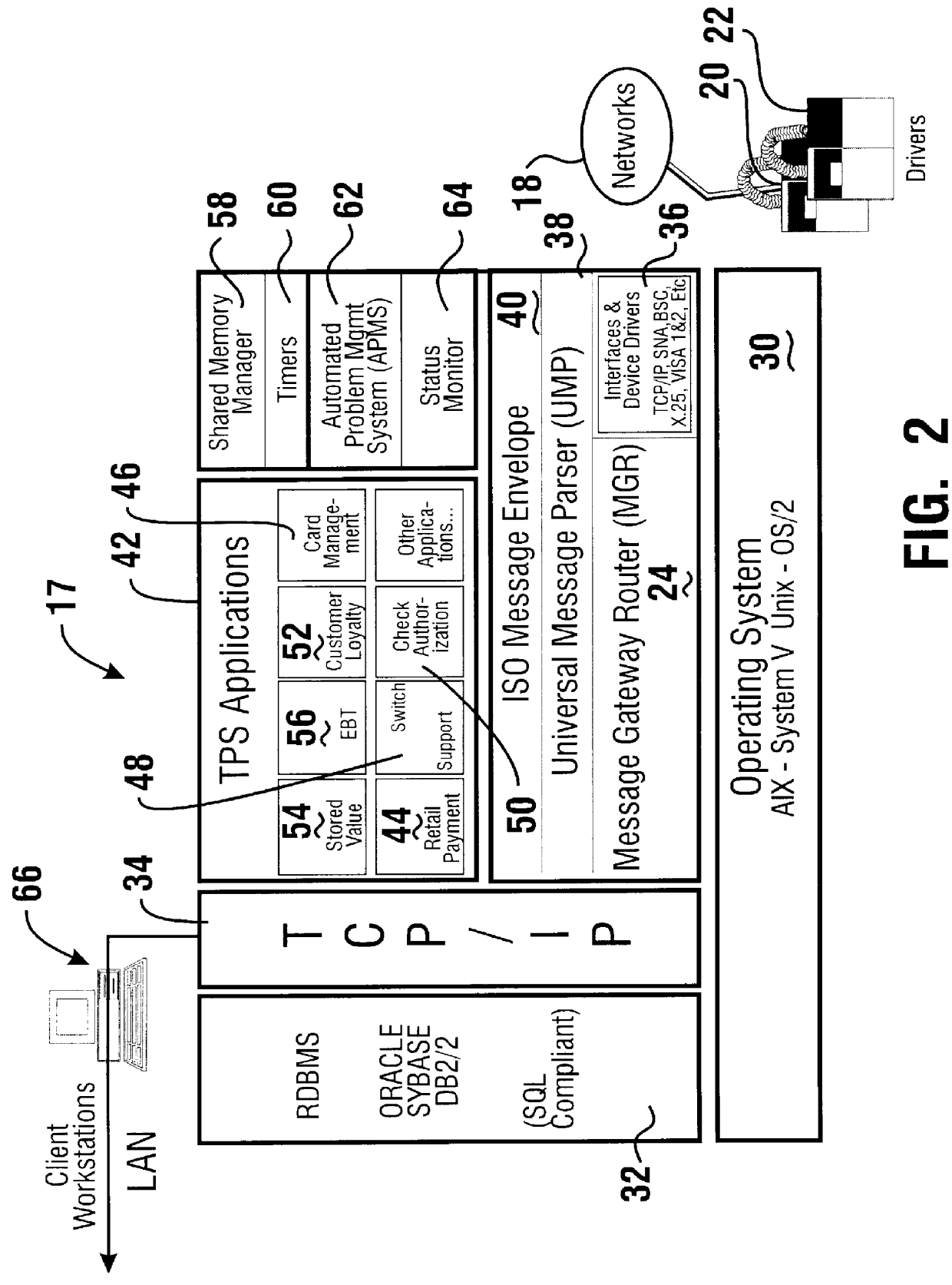

Financial transaction processing system and method

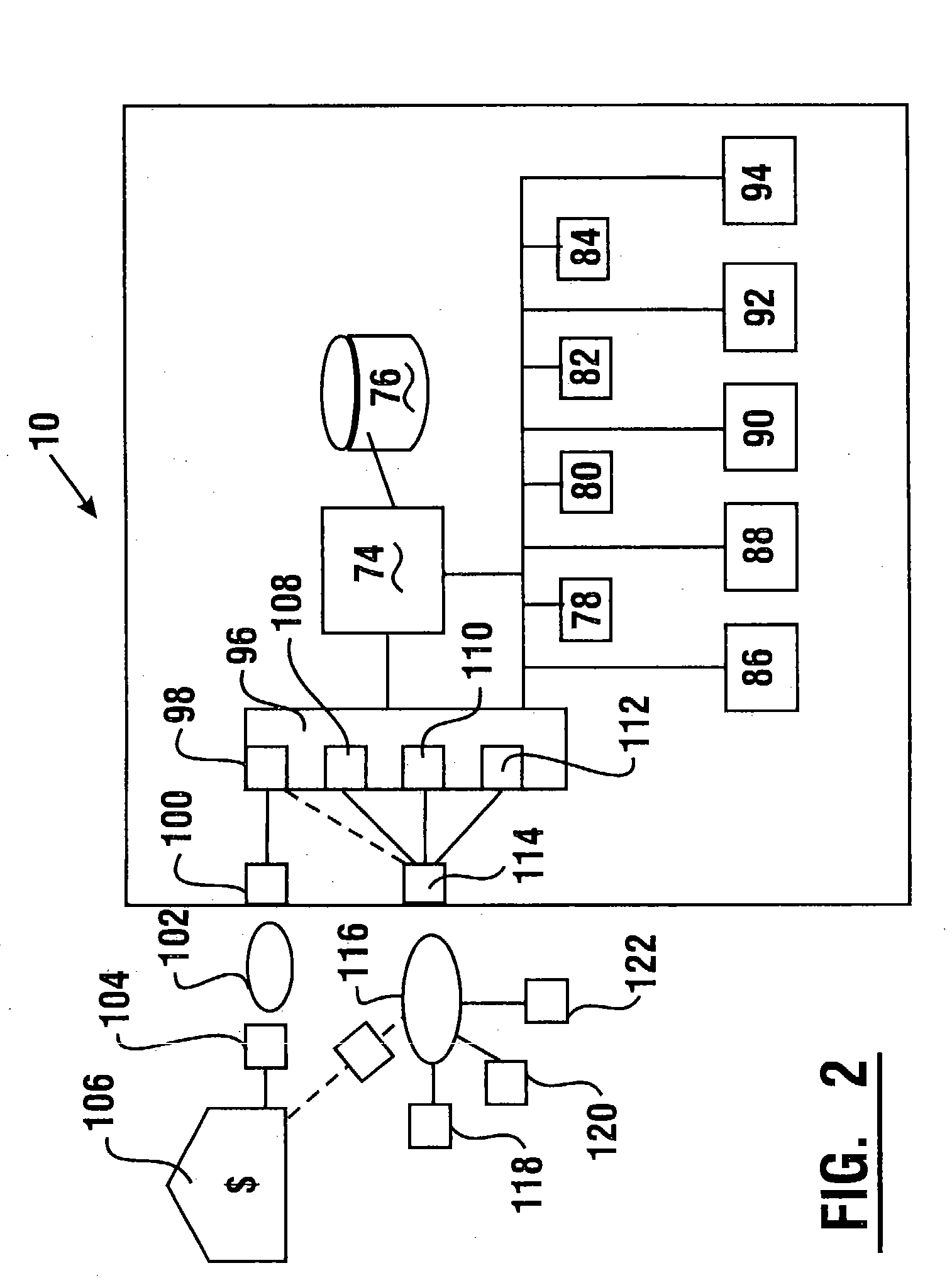

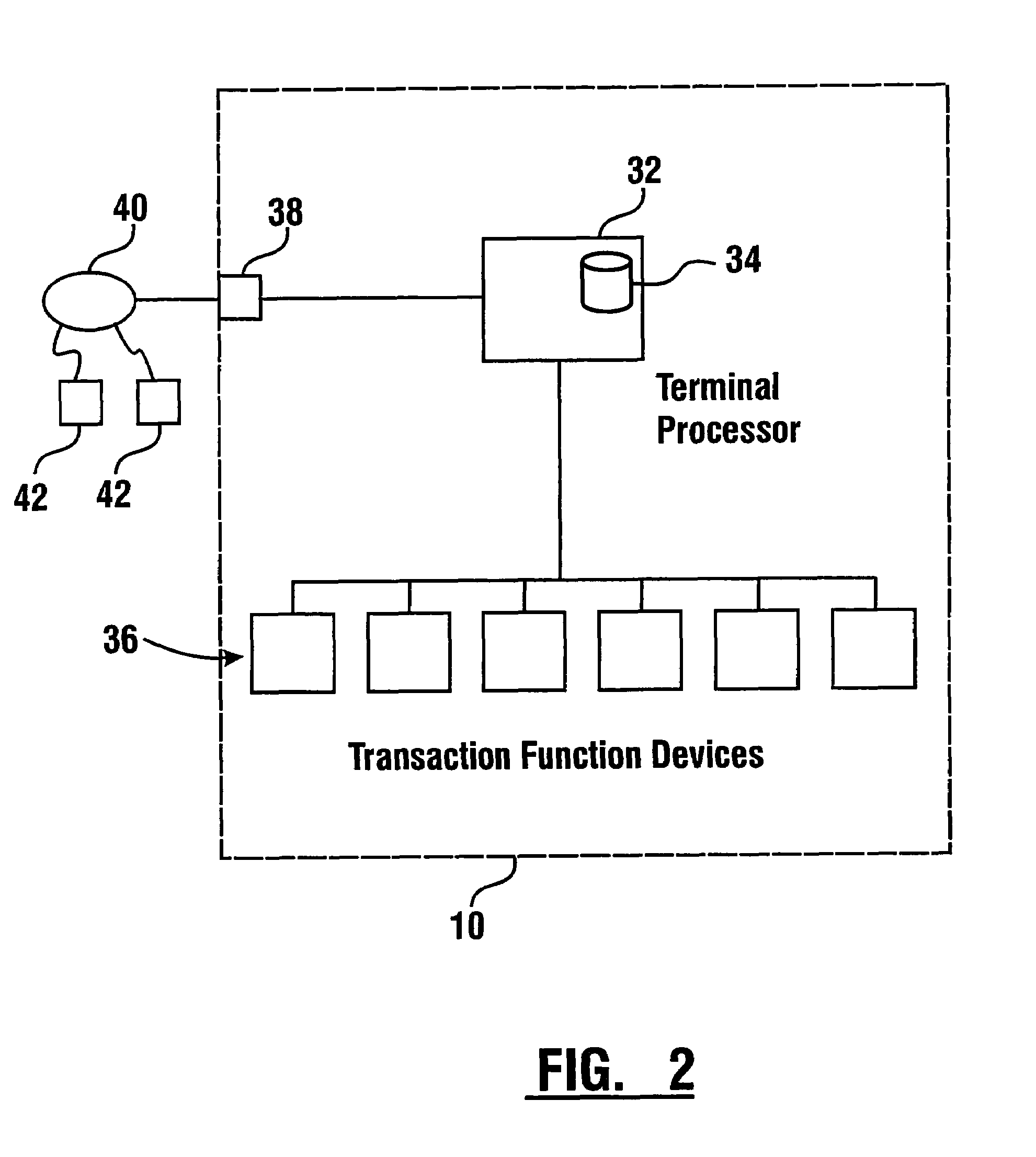

InactiveUS6039245AEasy to develop and modifyEasy to changeComplete banking machinesHand manipulated computer devicesRelational databaseTerminal equipment

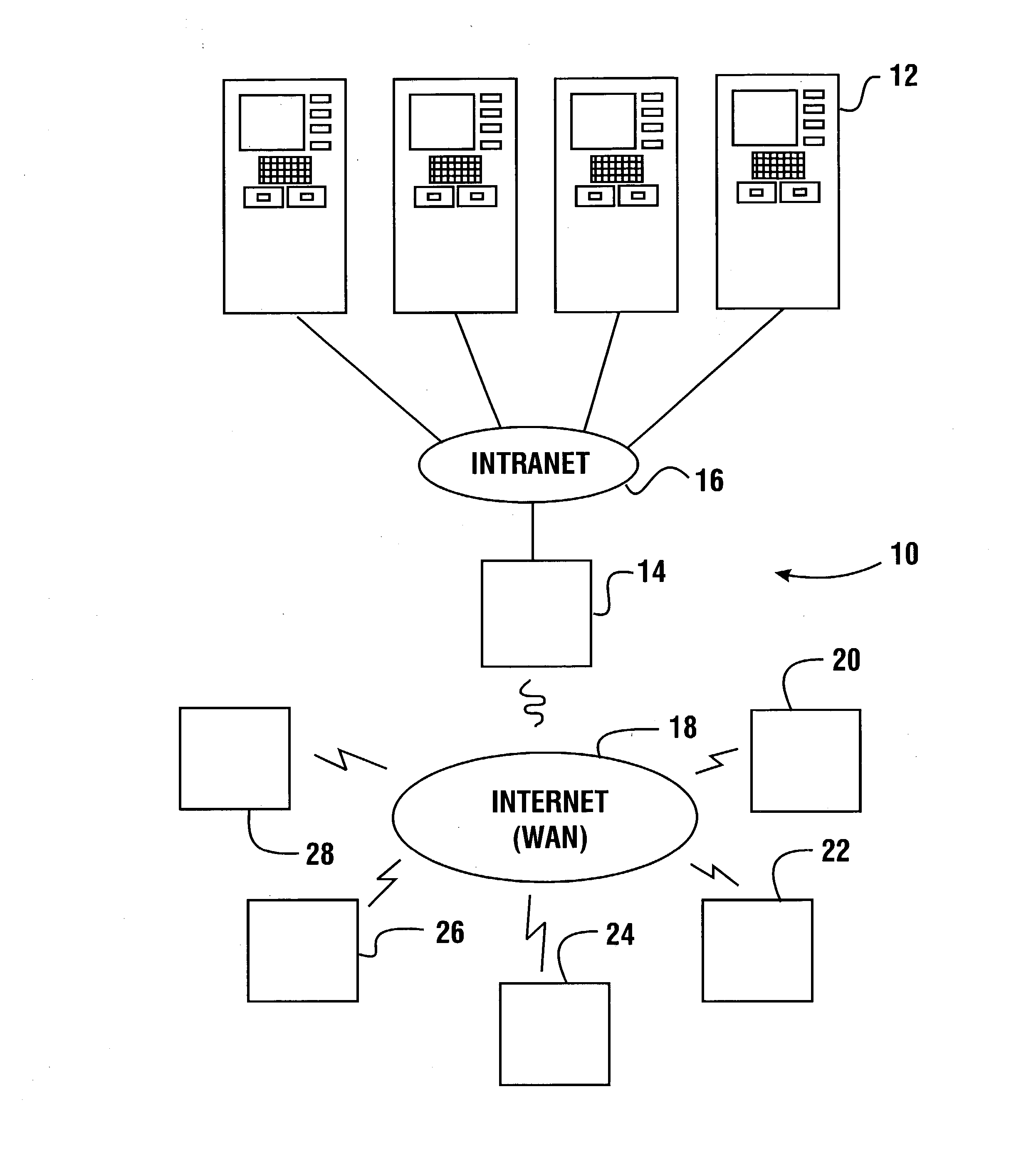

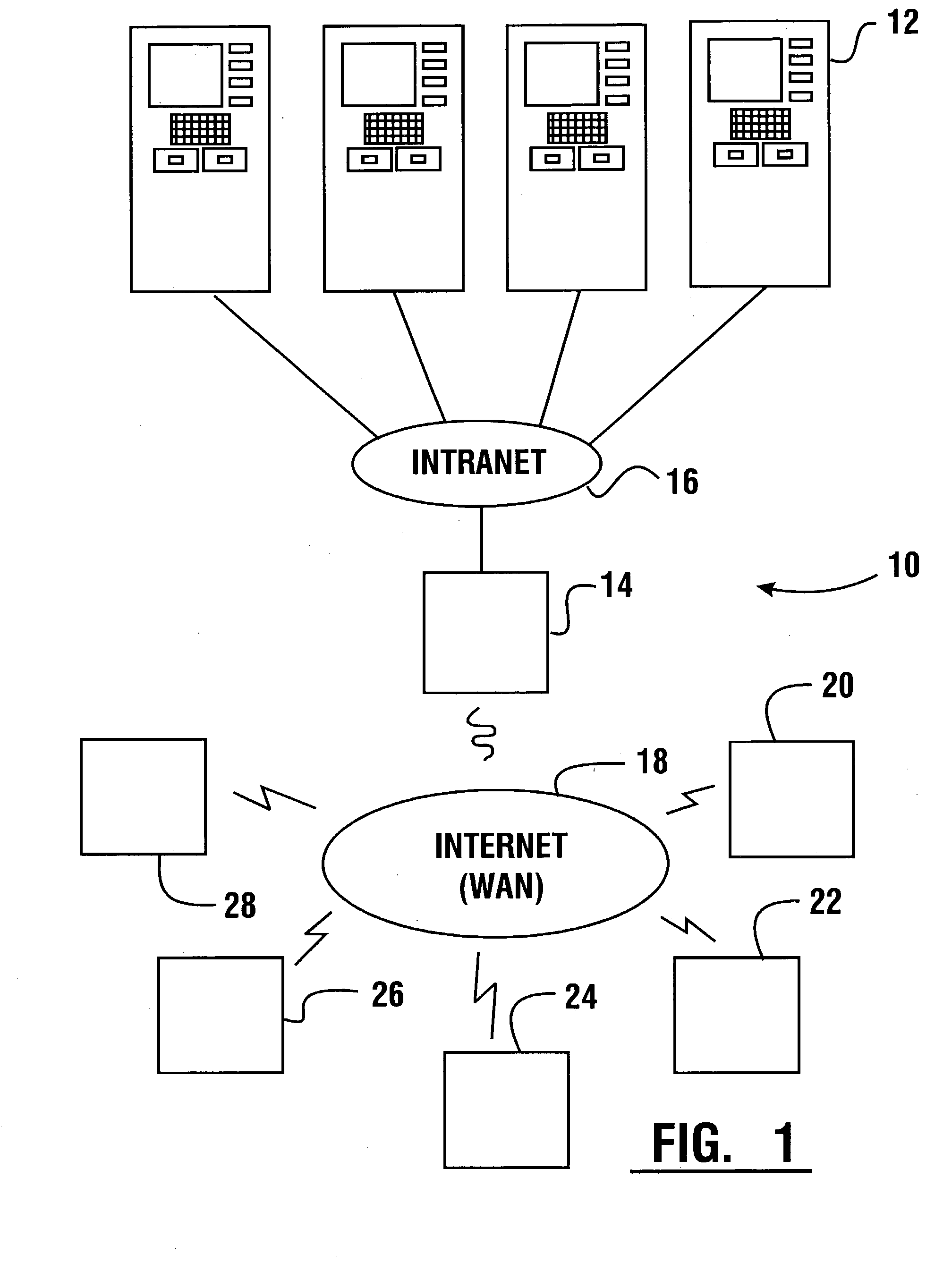

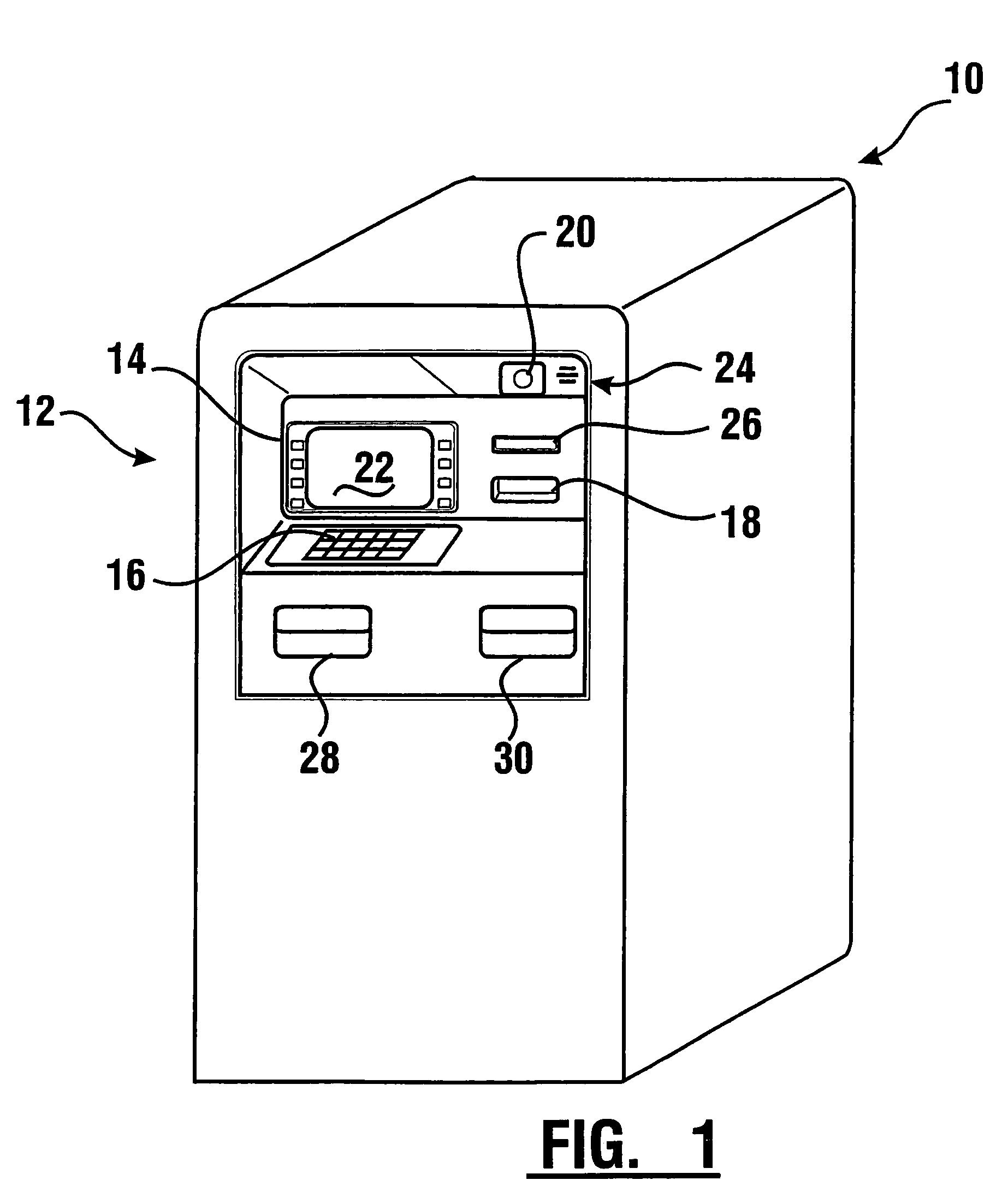

A financial transaction processing system (10) enables processing transactions from various types of card activated terminal devices (12) which communicate using a variety of electronic message formats. The transaction processing system may operate to authorize transactions internally using information stored in a relational database (32) or may communicate with external authorization systems (18). The transaction processing system includes among its software components message gateway routers (MGRs) (24, 164) which operate using information stored in the relational database to convert messages from a variety of external message formats used by the external devices and authorization systems, to a common internal message format used within the system. The system further uses database information to internally route messages to message processing programs (MPPs) (108, 138) which process messages and generate messages to the external devices and authorization systems. The MGR also converts the outgoing messages from the internal message format to the external message formats which can be interpreted by the external devices and systems to which the messages are directed.

Owner:DIEBOLD NIXDORF

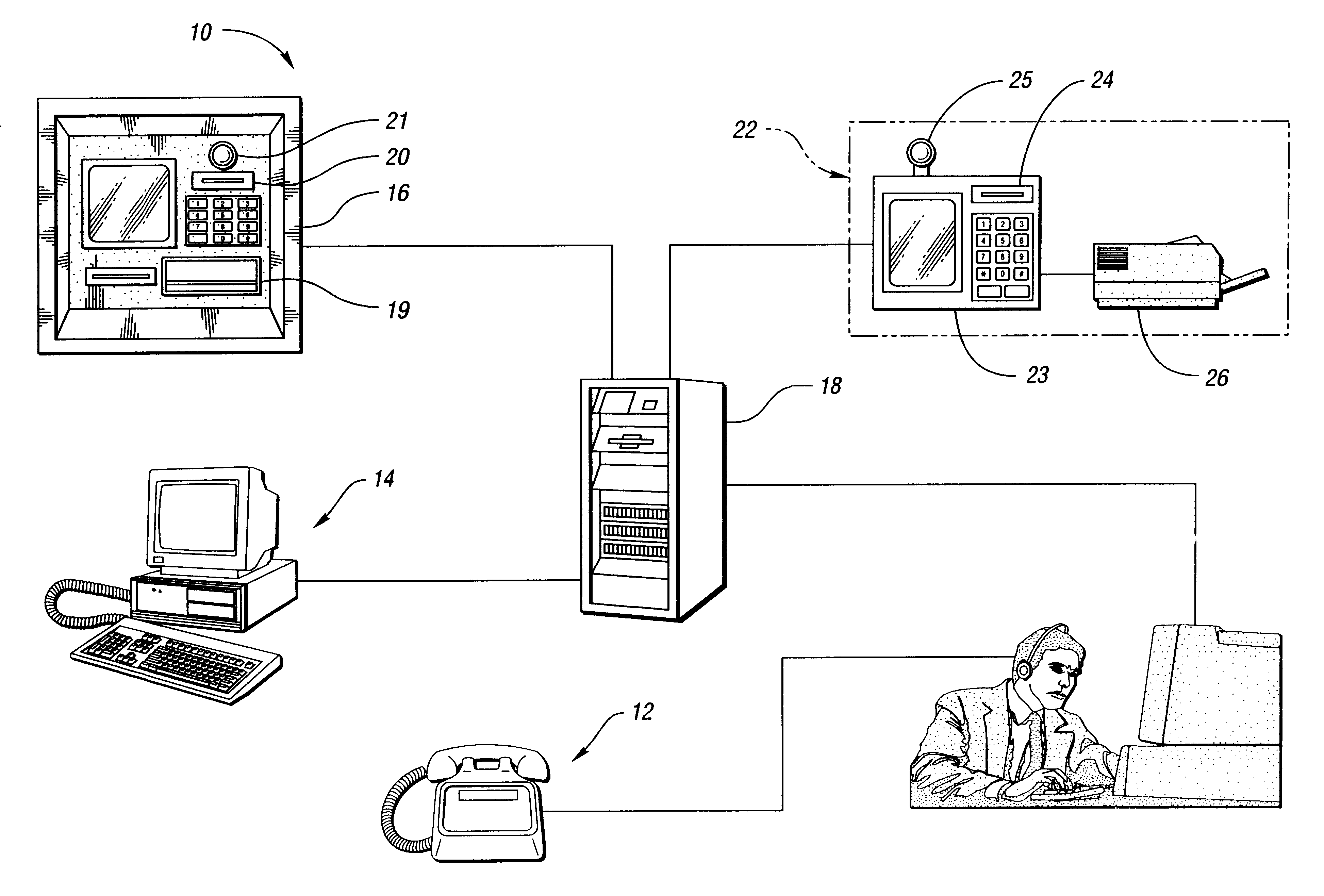

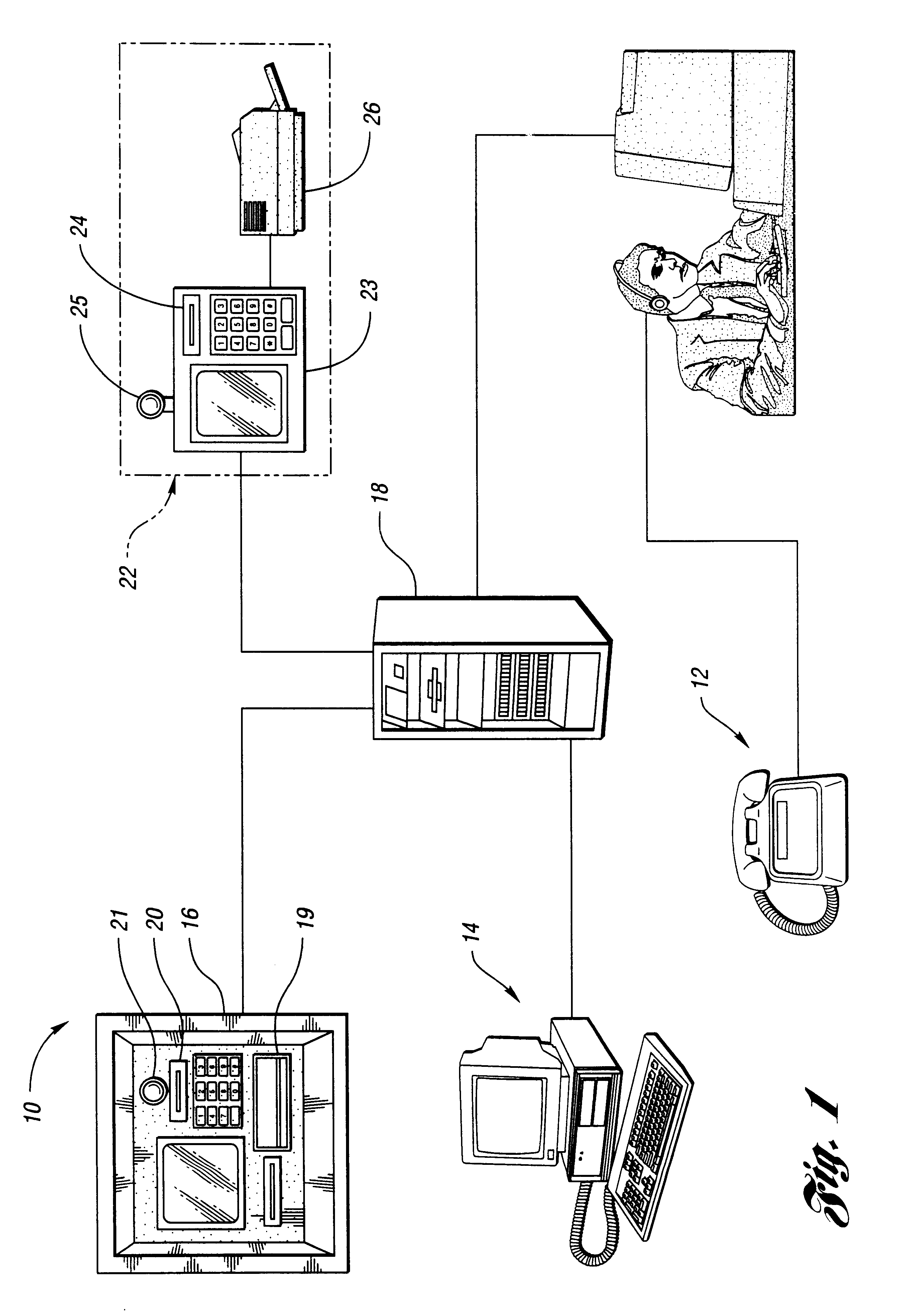

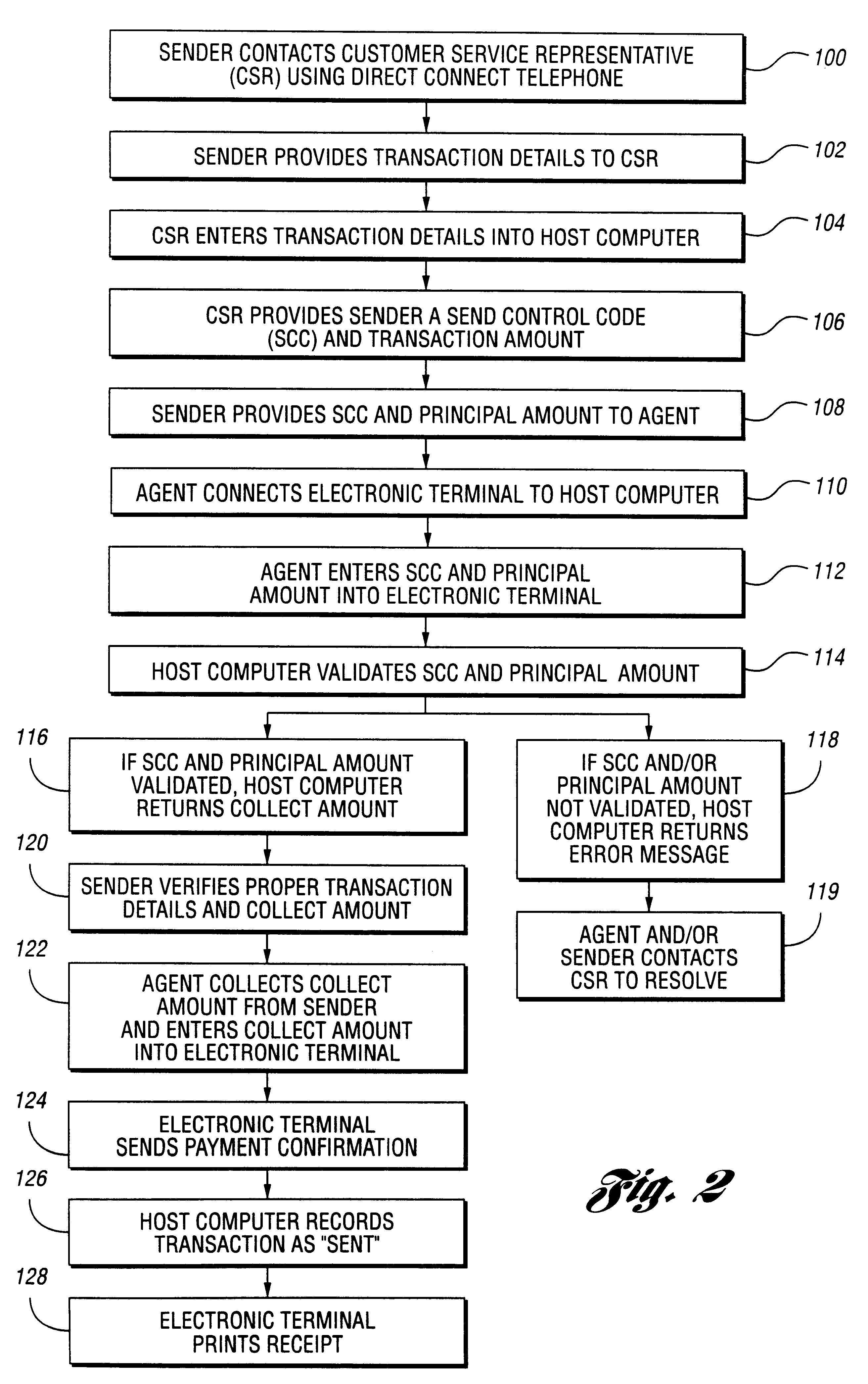

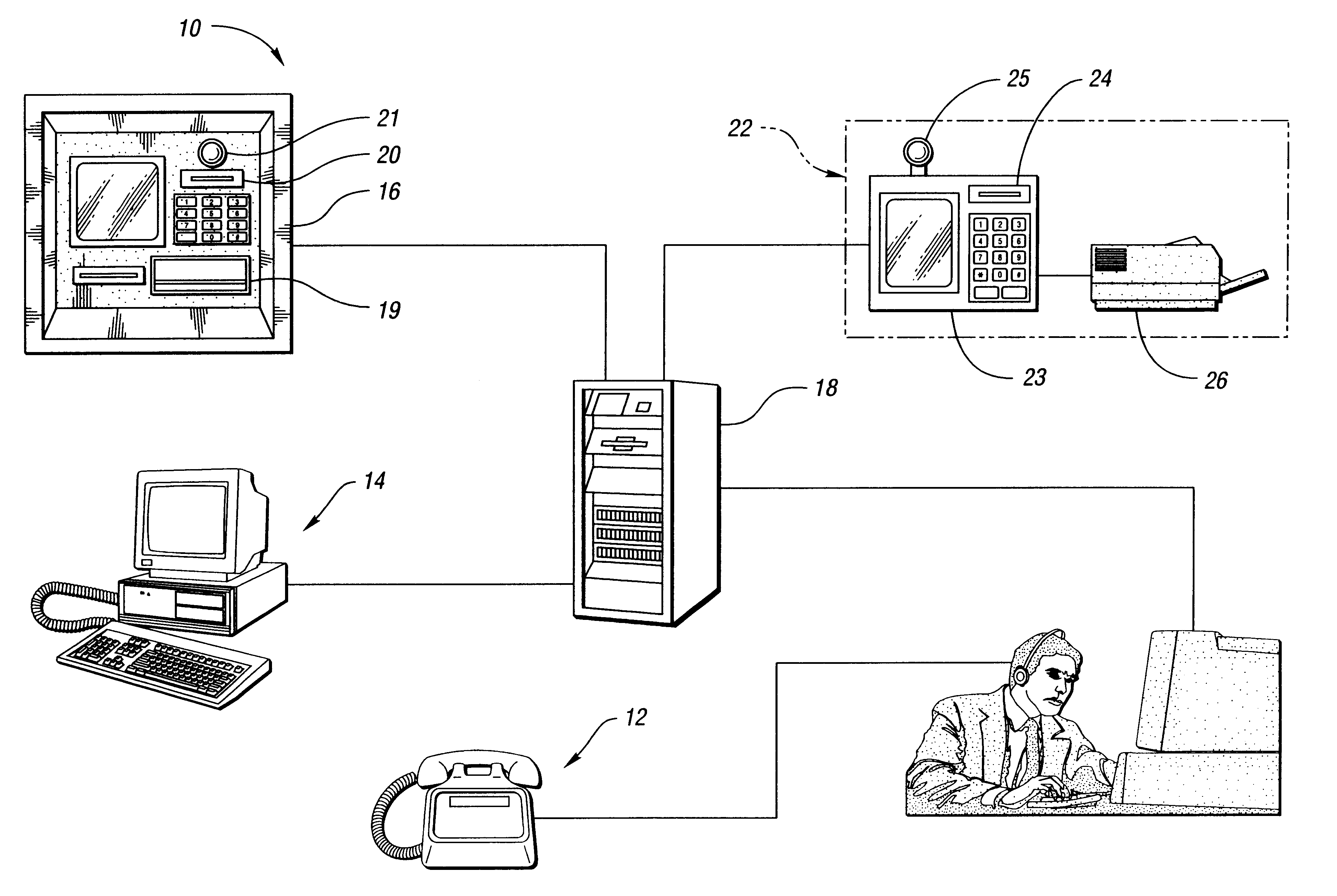

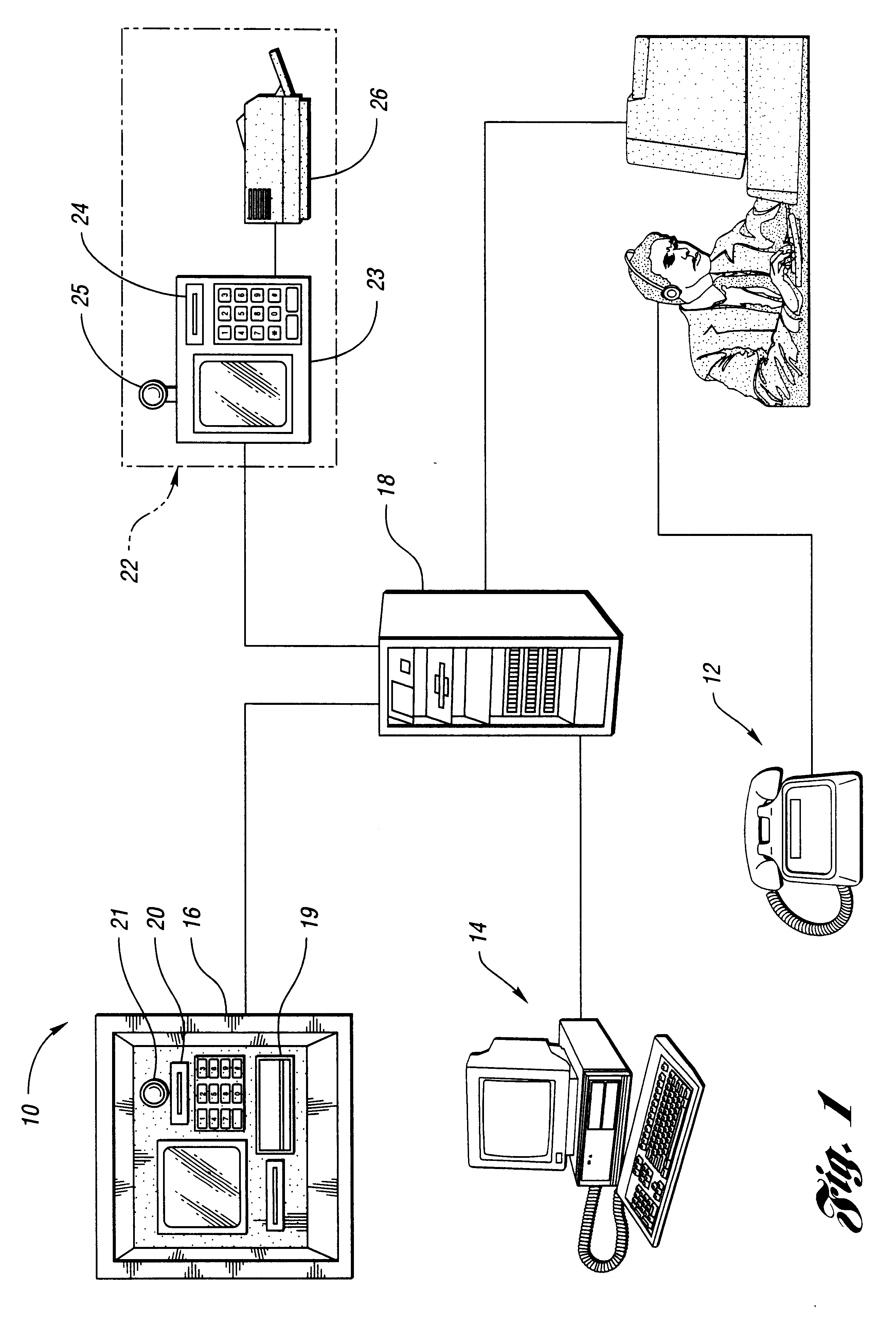

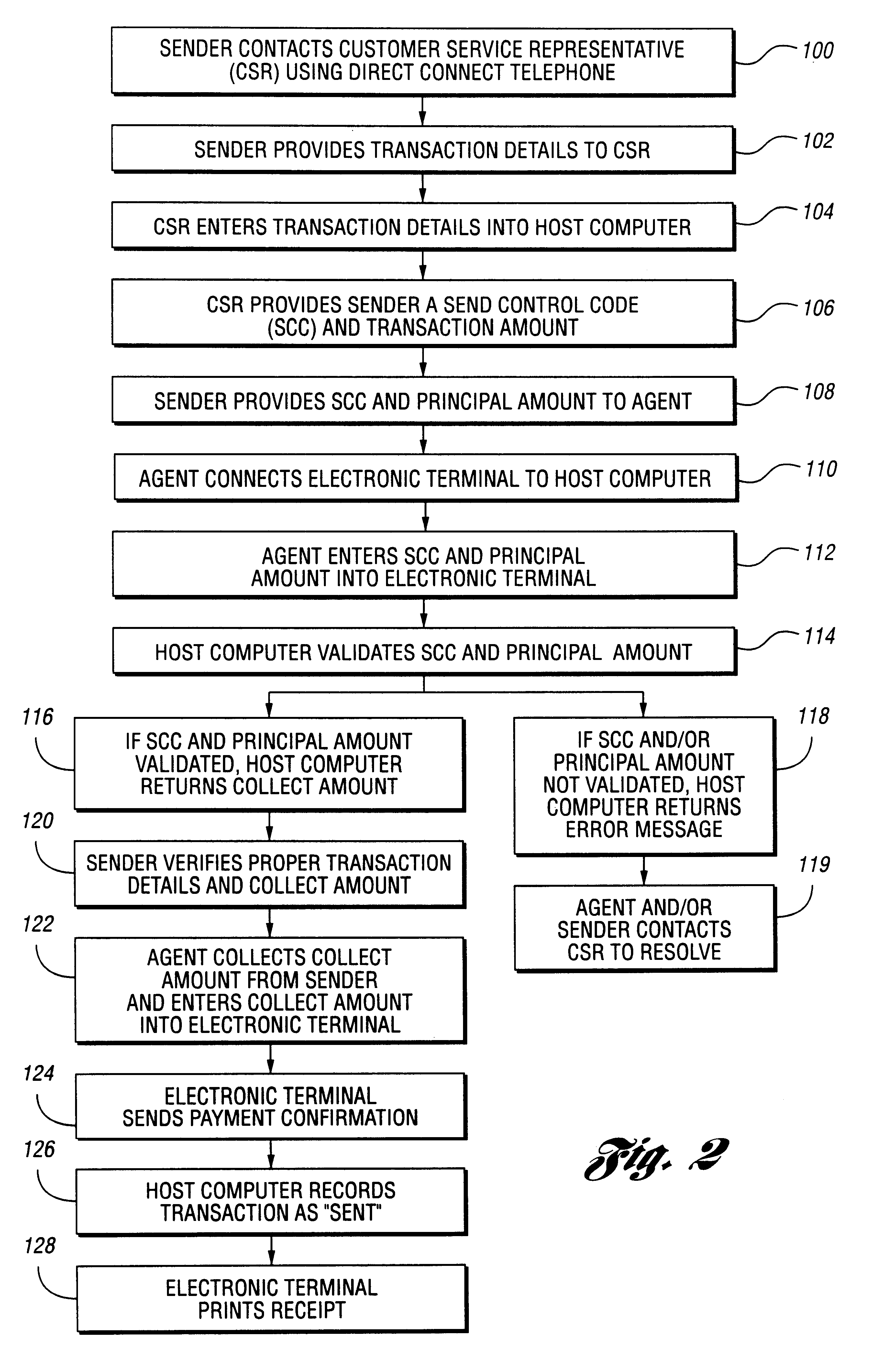

Method and system for performing money transfer transactions

InactiveUS6488203B1Shorten transaction timeImprove accuracyComplete banking machinesFinanceComputer scienceDatabase

A method of performing a send money transfer transaction through a financial services institution includes storing transaction details on a data base, wherein the transaction details include a desired amount of money to be sent; establishing a code that corresponds to the transaction details stored on the data base; entering the code into an electronic transaction fulfillment device in communication with the data base to retrieve the transaction details from the data base; and determining a collect amount based on the transaction details. A system for performing a send money transfer transaction is also disclosed.

Owner:THE WESTERN UNION CO

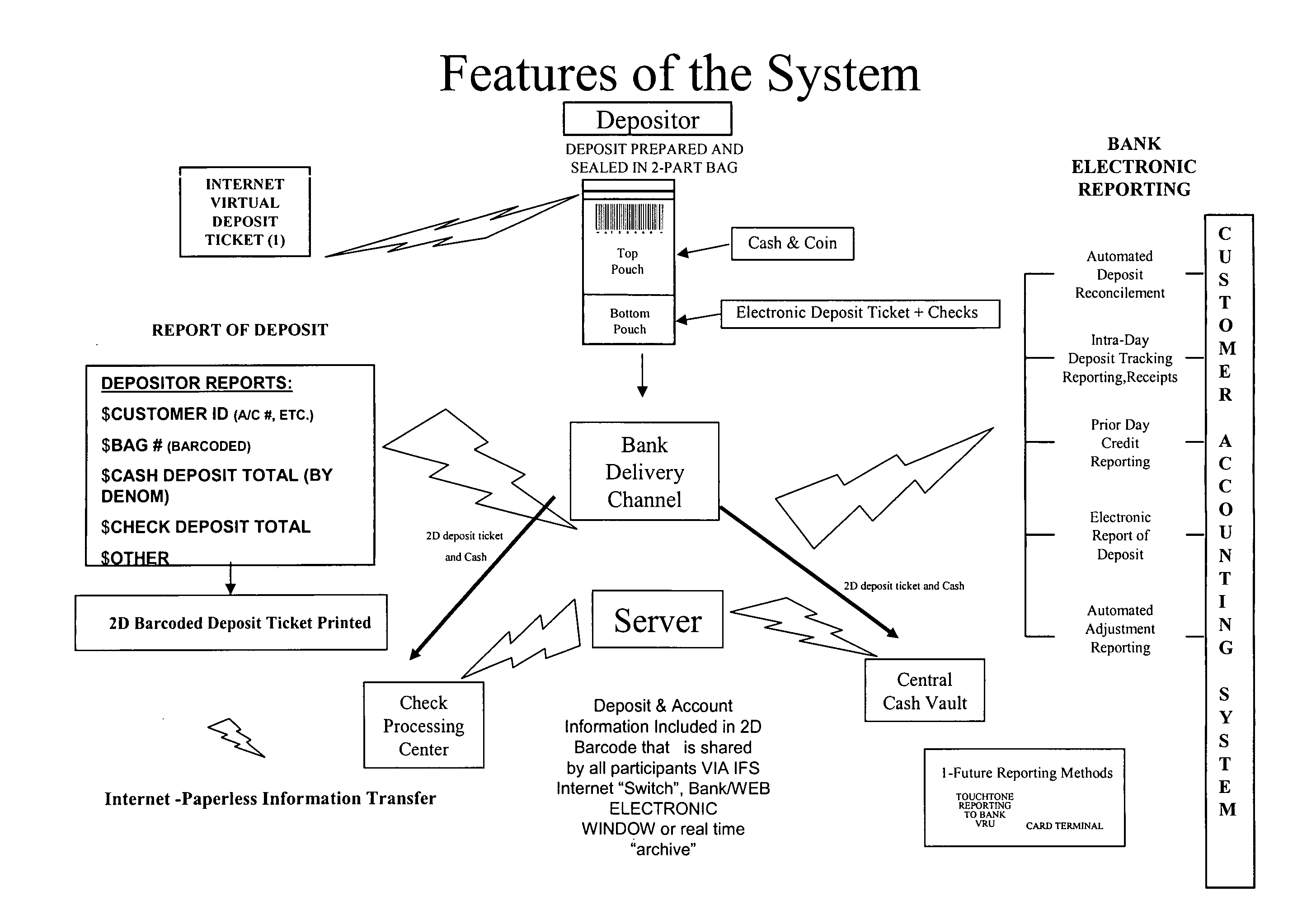

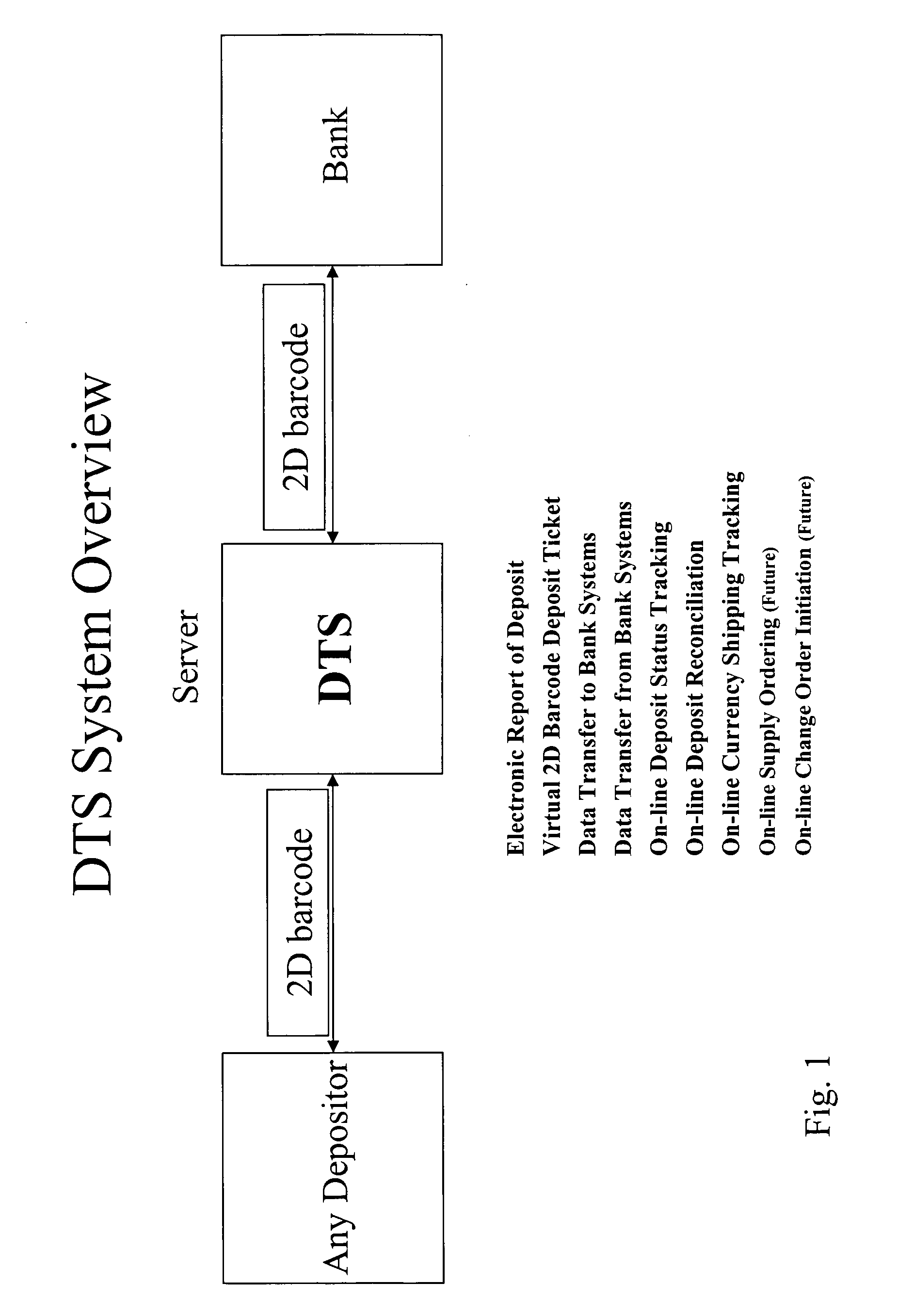

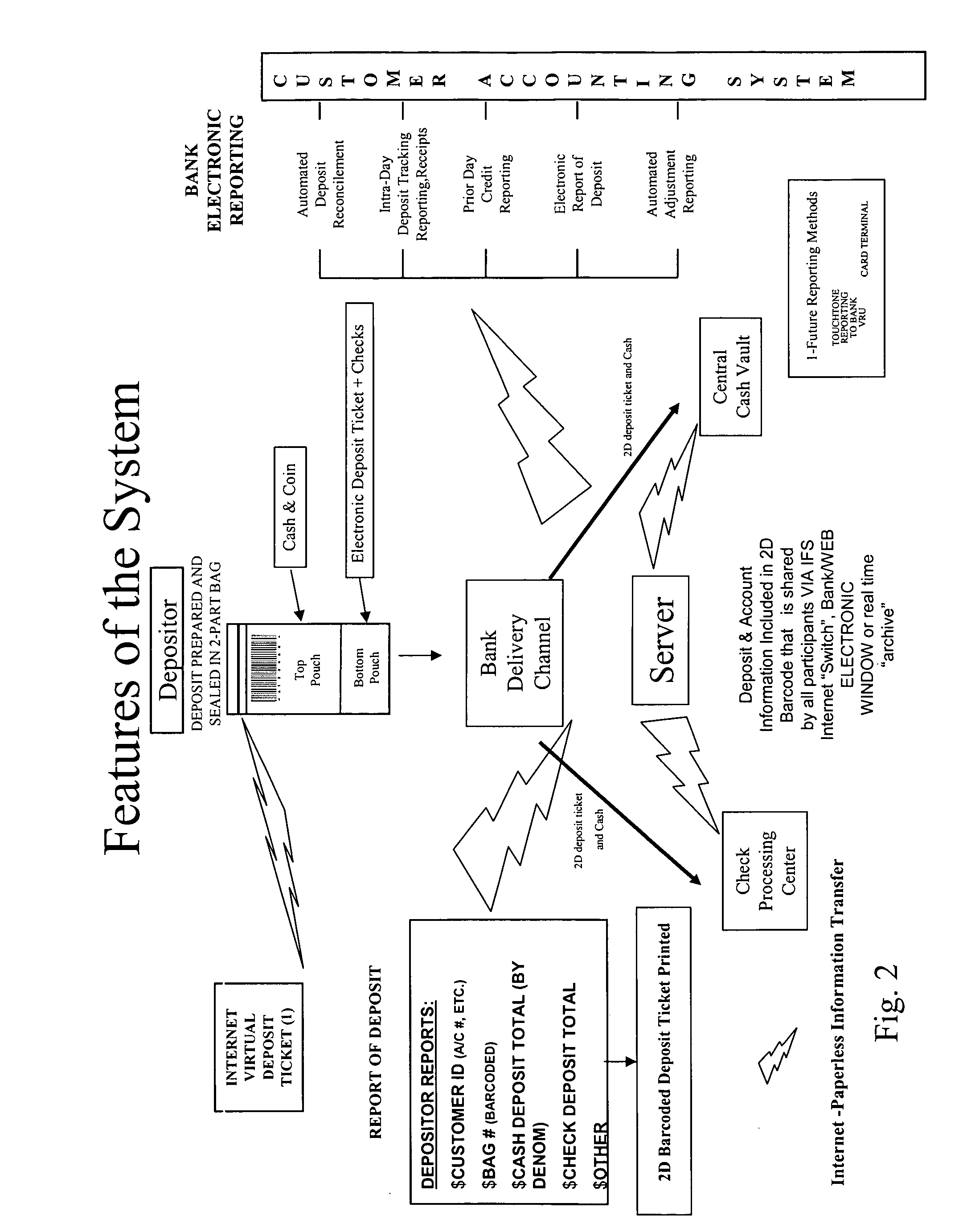

System and method to create electronic deposit records and to track the status of a deposit

A method of making, tracking and confirming the receipt of bank deposits by a user to a financial institution is disclosed. The method includes first accessing a user account on a database, entering deposit information including the account number and amount of the intended deposit on the database to create an electronic deposit record, and then encoding the deposit information in a machine readable format. The information is then associated with the encoded deposit information in close proximity with the deposit, creating a deposit package. The package is then transmitted to a financial institution or armored car carrier where the machine readable encoded deposit information is read and transmitted to a database that contains information about the account and status of the deposit.

Owner:INT FINANCIAL SERVICES

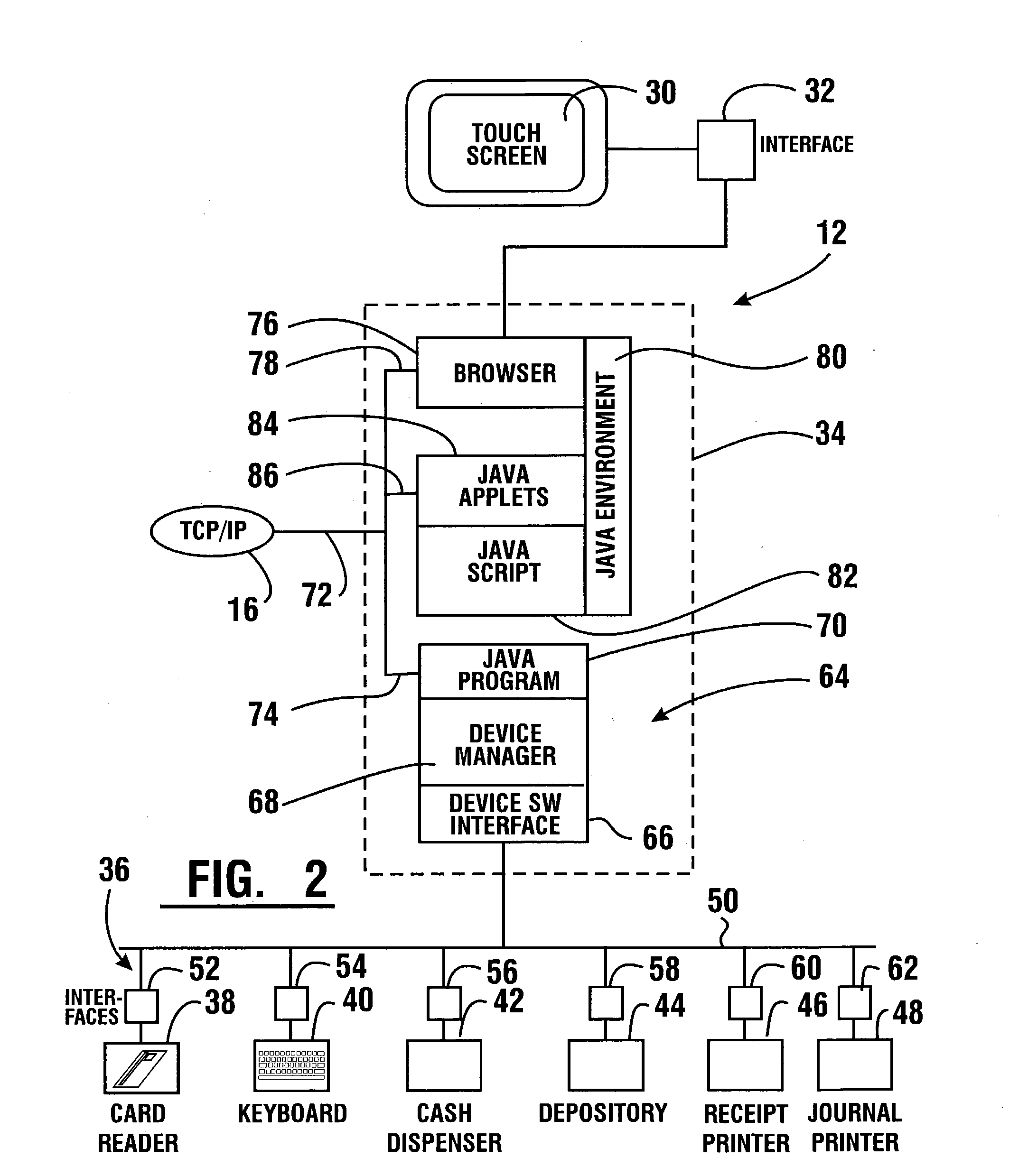

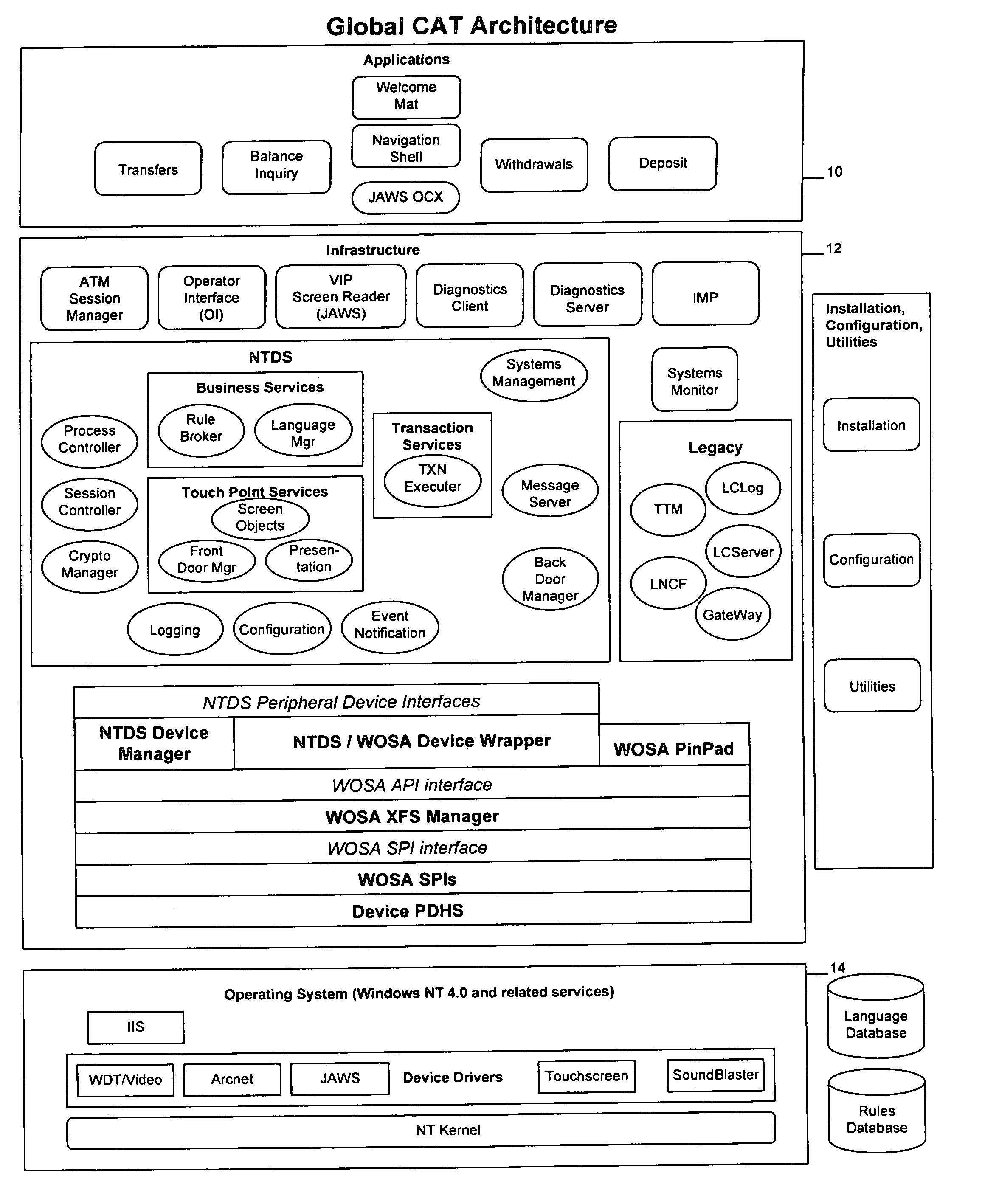

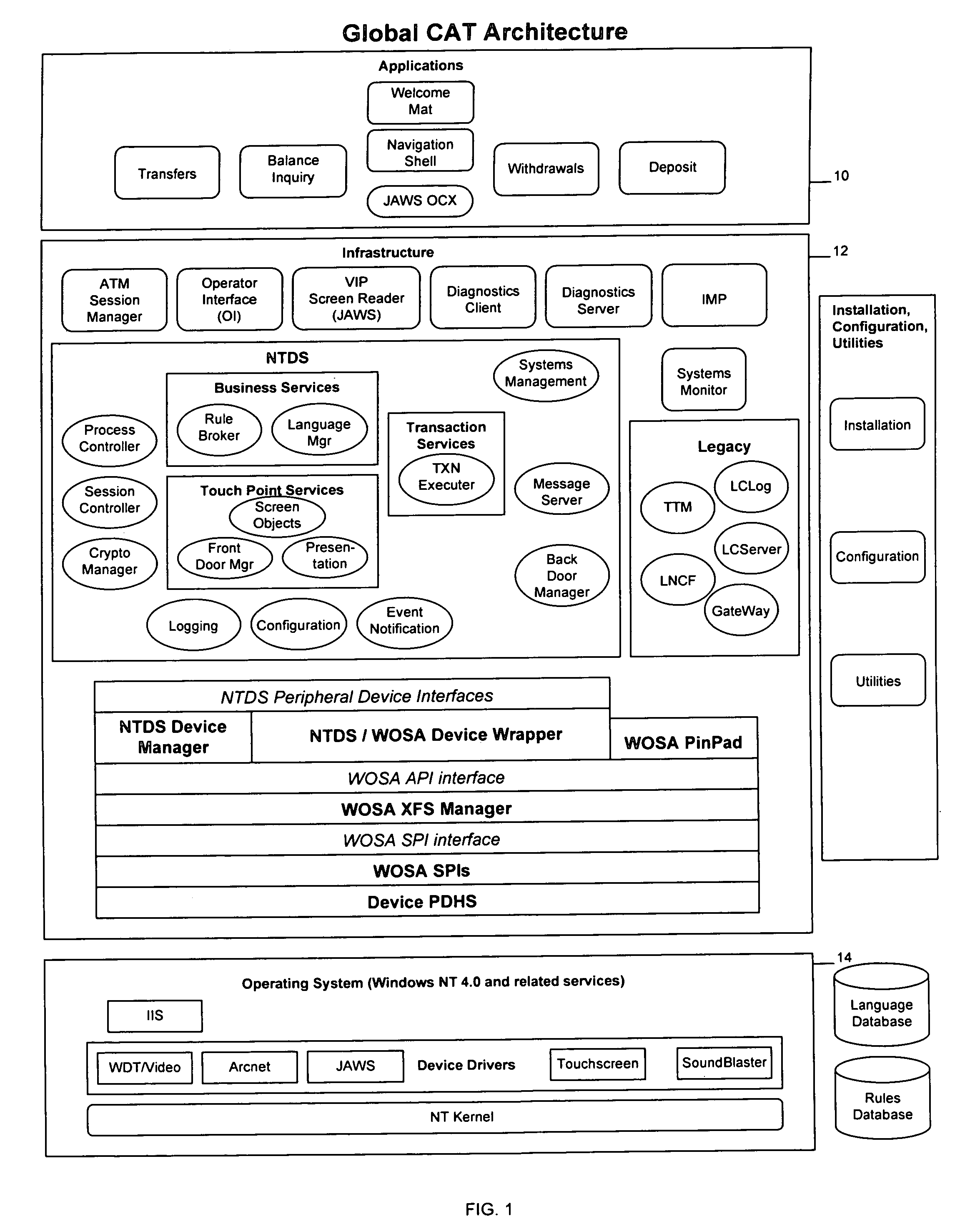

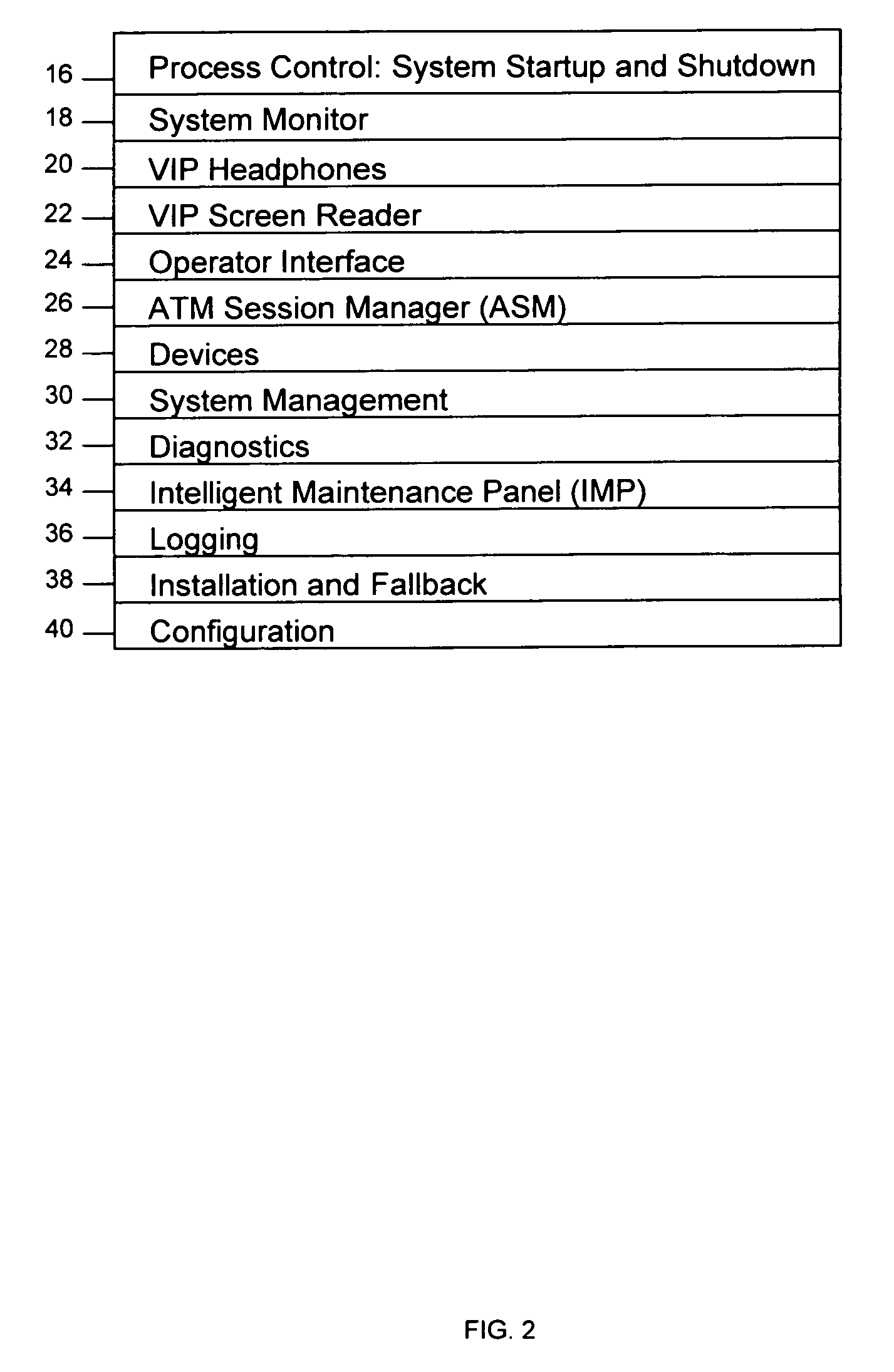

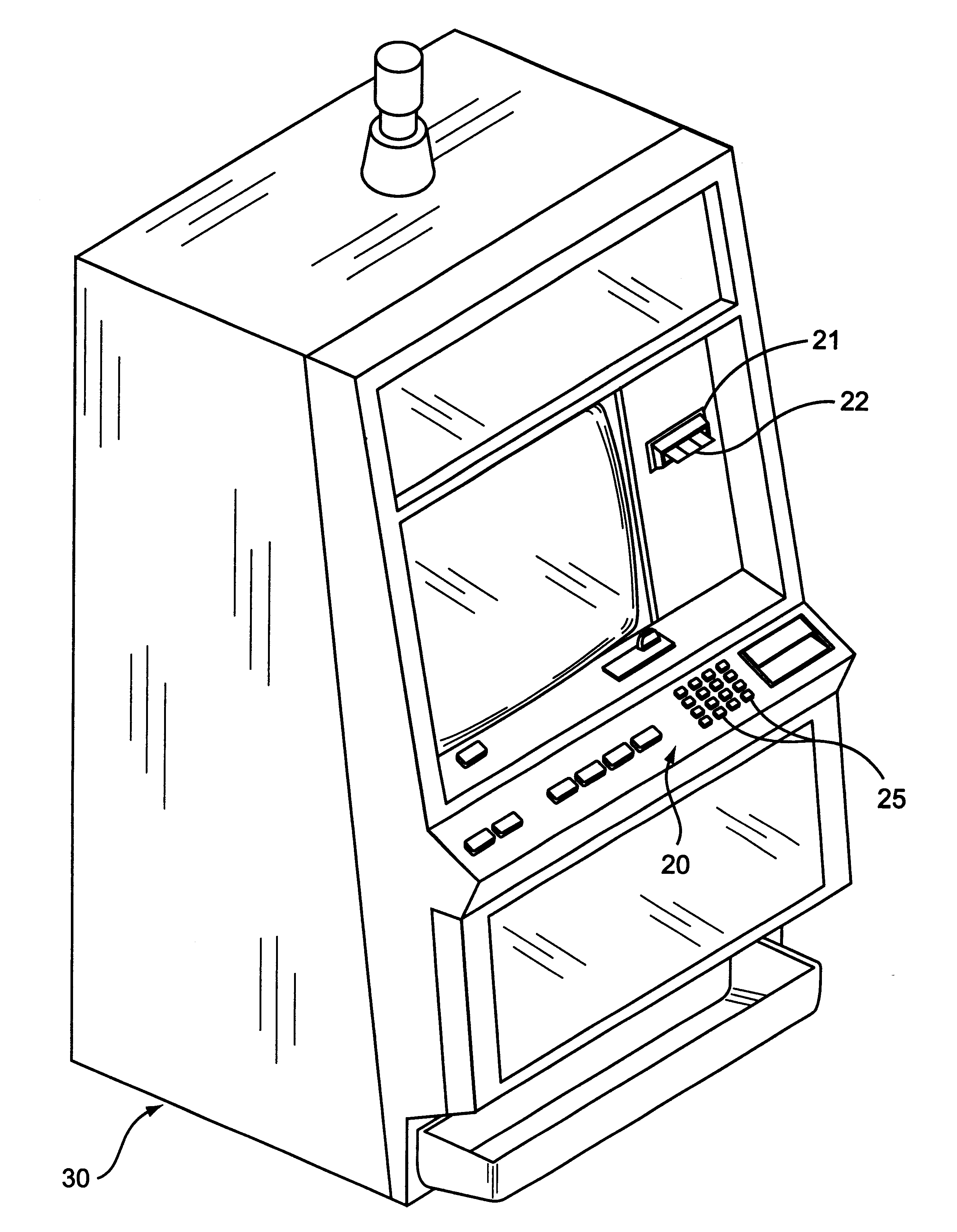

System and method for providing global self-service financial transaction terminals with worldwide web content, centralized management, and local and remote administration

A method and system for providing global self-service transaction terminals or automatic teller machines (ATMs) affords worldwide web content to ATM customers, centralized management for ATM operators, and supports local and remote administration for ATM field service personnel. The system includes multiple ATMs coupled over a network to a host, and the ATMs are provided with a touch screen interface and an interface for visually impaired persons. The ATMs enable both local and remote administration of ATM operations by bank personnel and an integrated network control. The ATMs are web-enabled, and ATM communications are performed over a communications network.

Owner:CITICORP CREDIT SERVICES INC (USA)

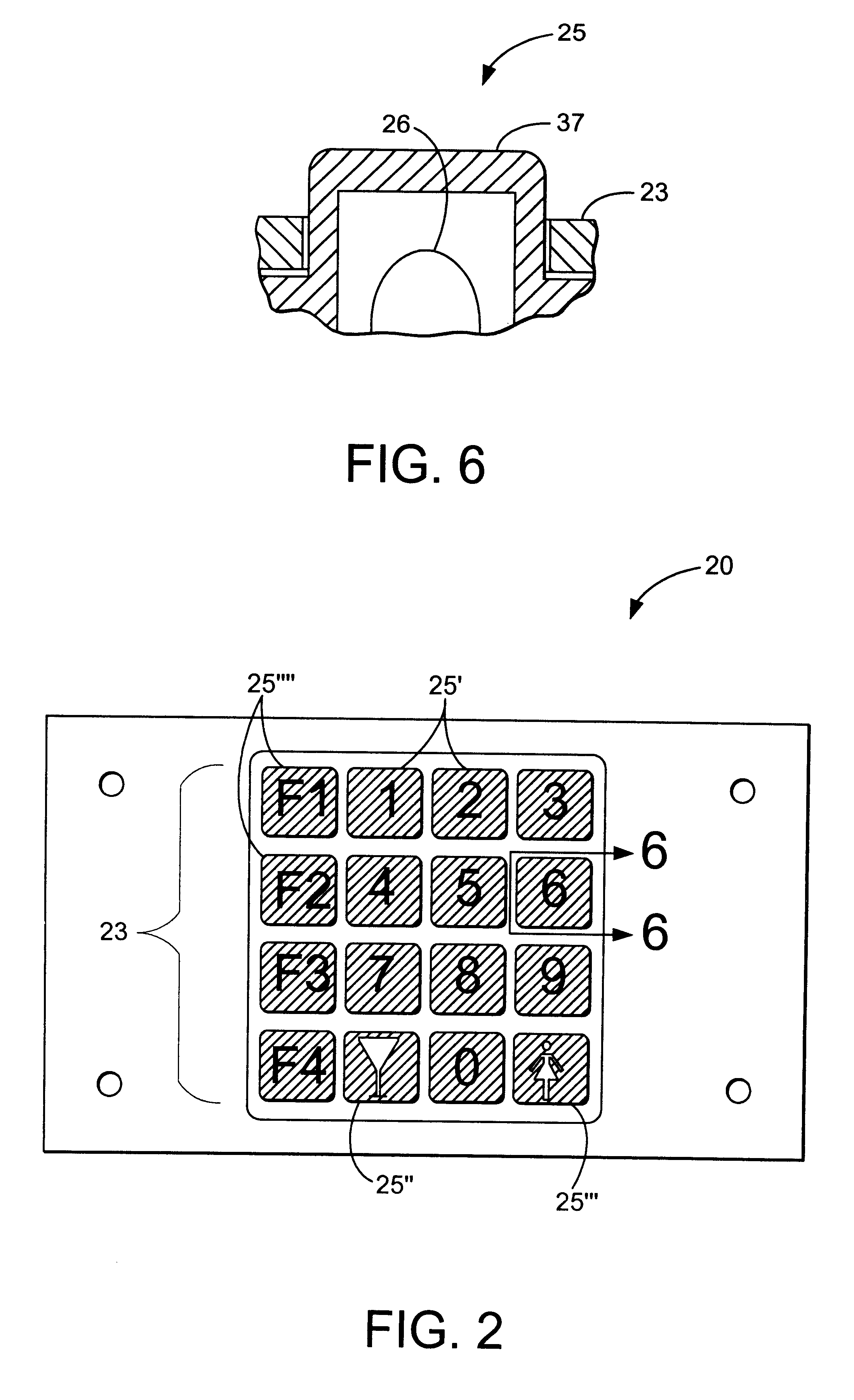

Lighted keypad assembly and method for a player tracking system

InactiveUS6409595B1Improve system efficiencyComplete banking machinesElectric/electromagnetic visible signallingCard readerTracking system

A keypad assembly and method for use with a card reader adapted to receive and read a player identification card therein. The keypad assembly includes a keypad mechanism having a plurality of keys to input data, and a feedback mechanism coupled to the keypad. A validation device is provided which is adapted to determine the validation of information relating to the identification card upon reading thereof in the card reader. The validation device is further operably coupled to the feedback mechanism to visually inform the Player that the information relating to identification card has been validated.

Owner:IGT

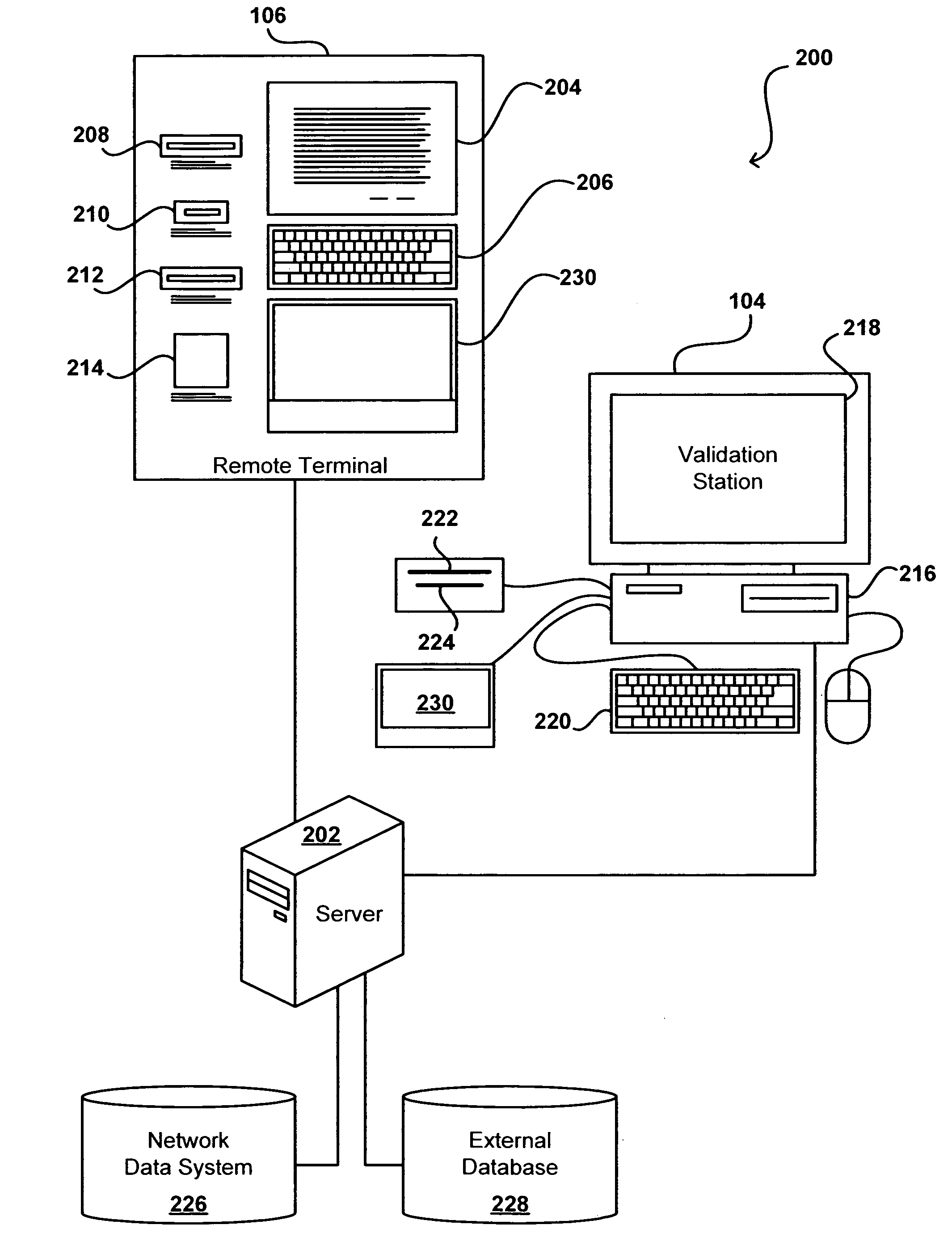

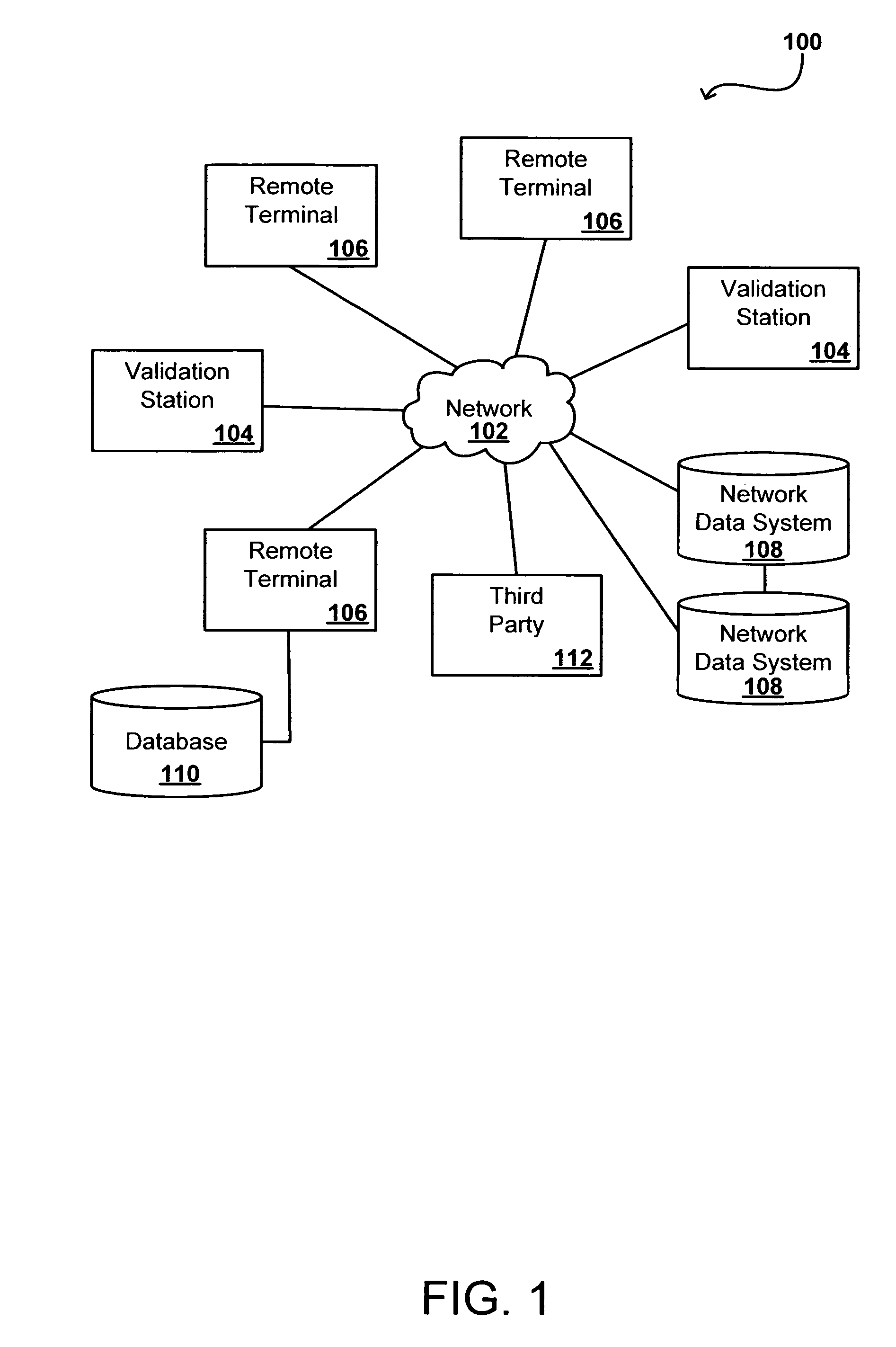

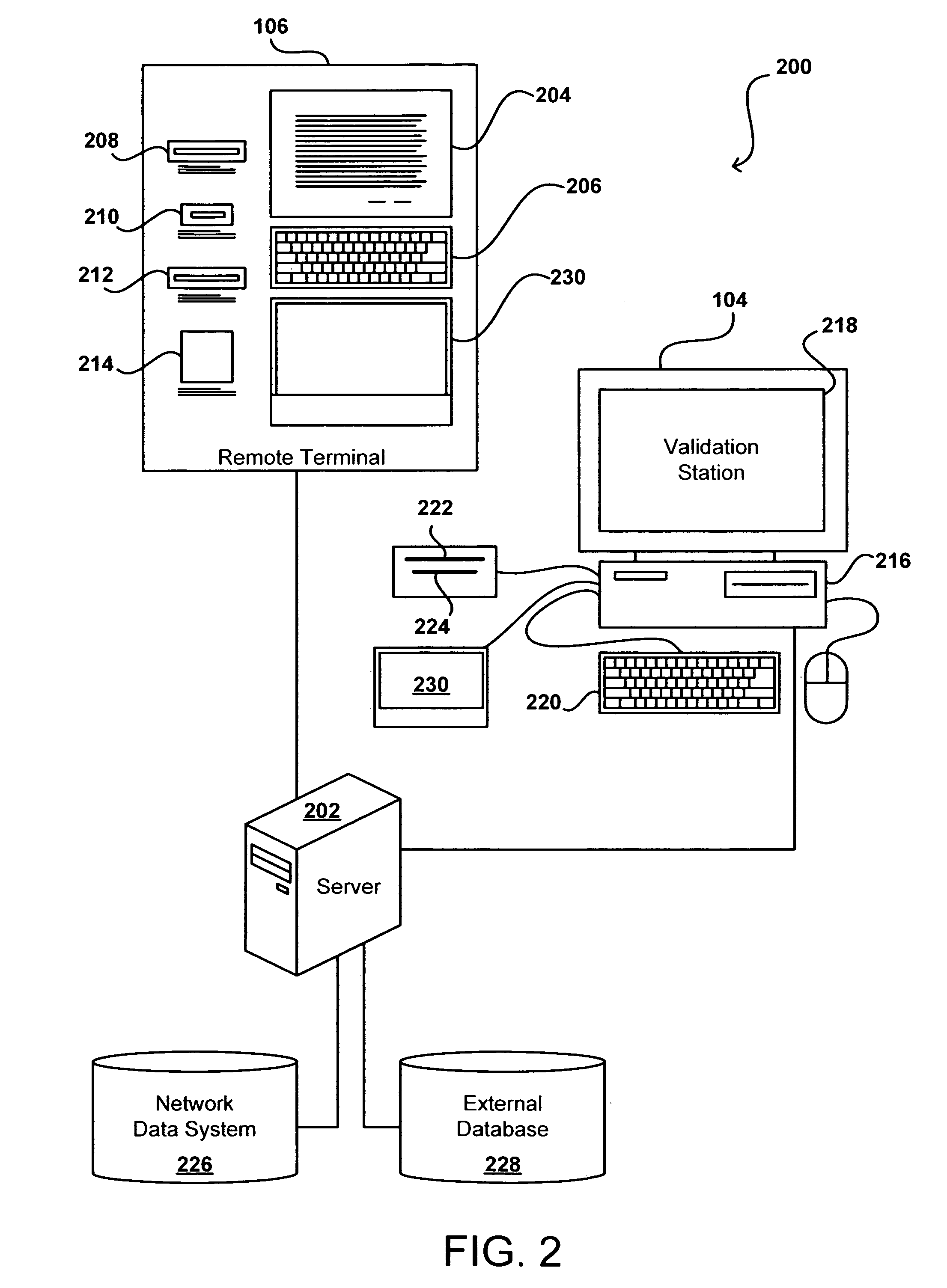

Remote validation system useful for financial transactions

A financial services and transaction network including multiple networked validation stations and remote terminals allows users to access a number of financial services and transactions. A user visiting a remote terminal indicates a desired service or transaction. The user provides any currency or funding information needed for the selected service, after which the remote terminal issues the user a transaction voucher. The user can take this transaction voucher to any of the validation stations in order to authenticate the user's identity and activate the voucher. Once the voucher is activated, the user or a recipient of the voucher can present the voucher at any remote terminal to receive funding or otherwise complete the transaction or service, subject to recipient authentication. The user provides necessary information using the remote terminal or validation station, or supplies the information using the voucher, which is collected upon performance of the requested service or transaction.

Owner:CUCINOTTA ROBERT

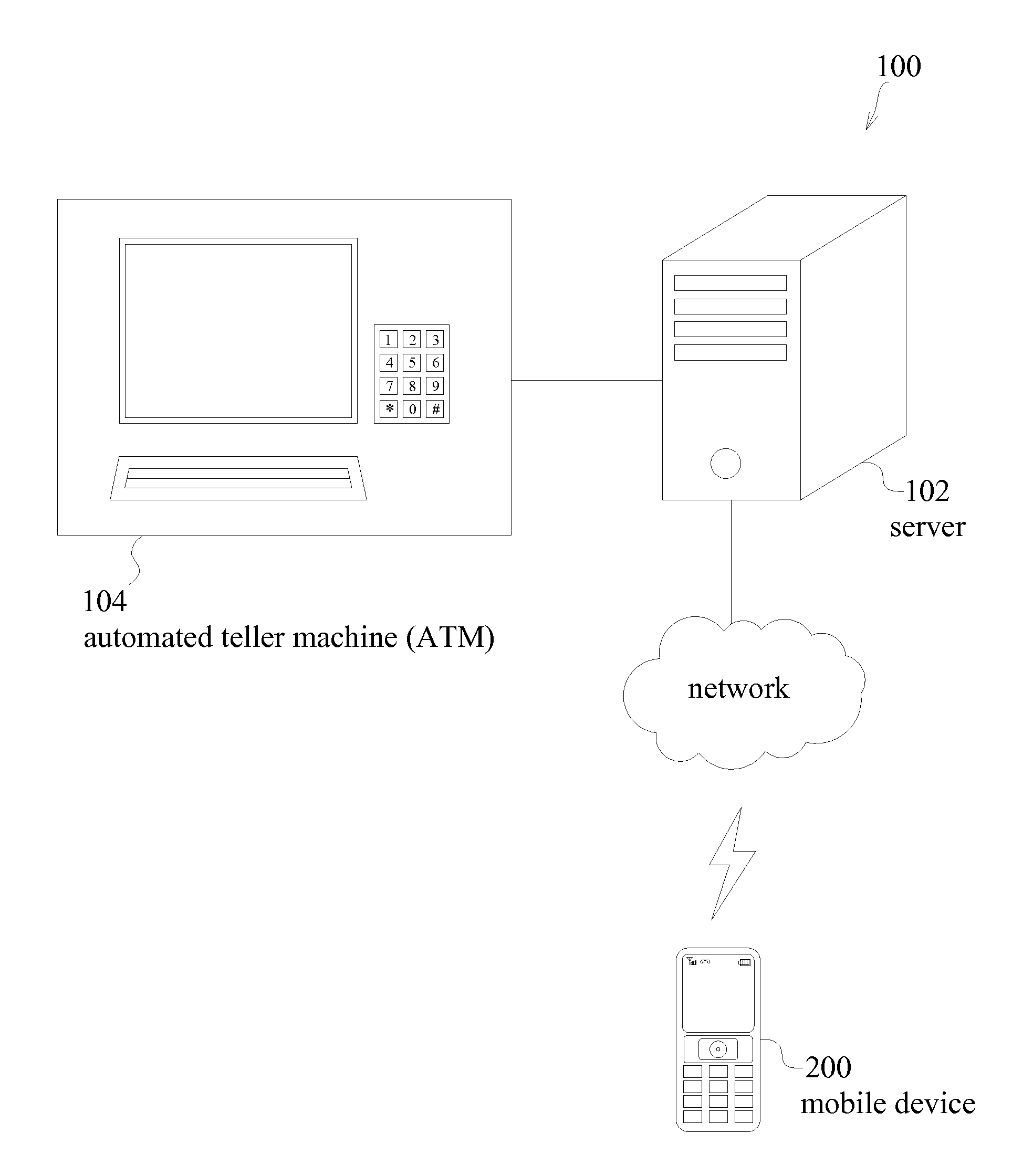

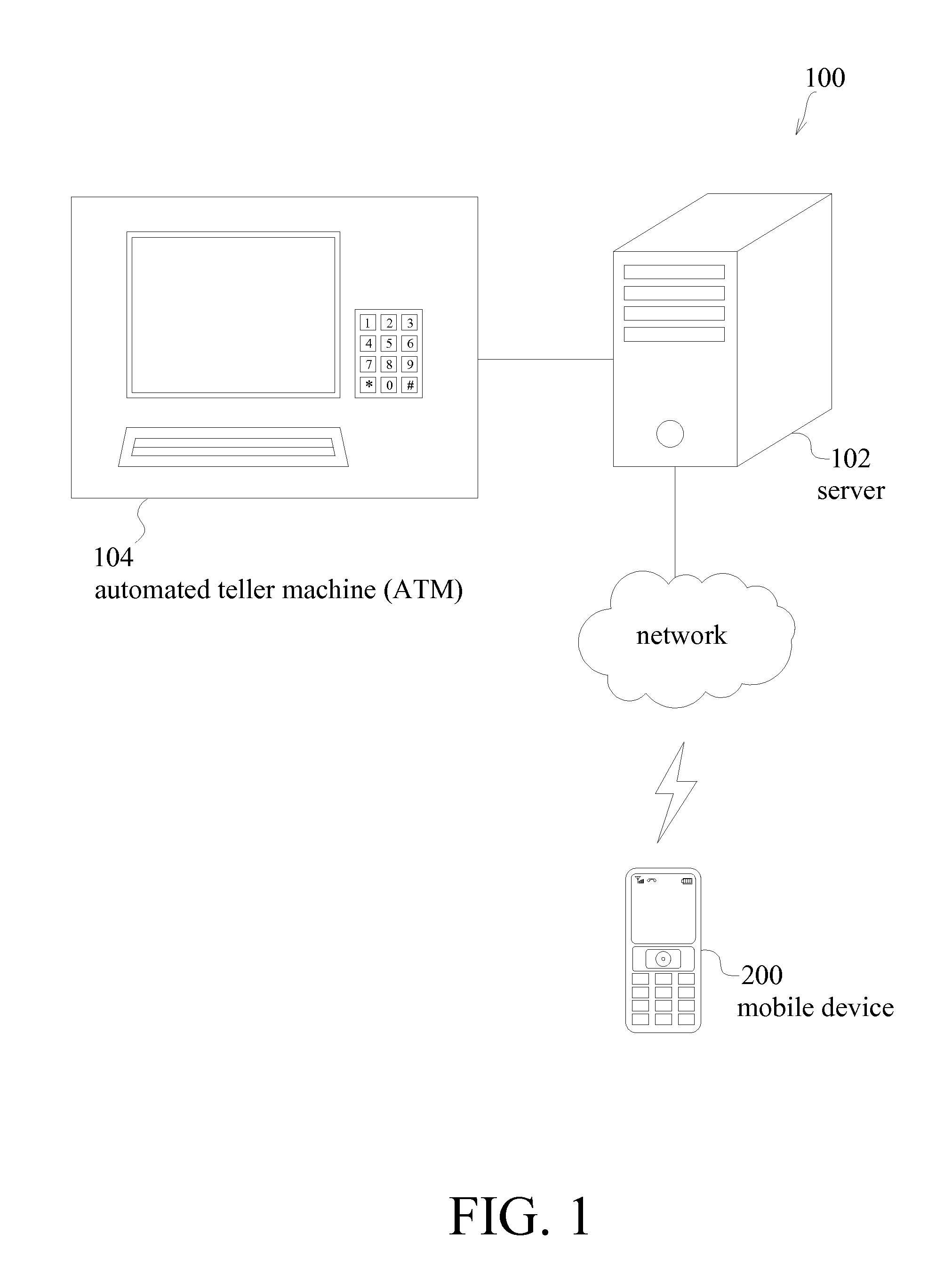

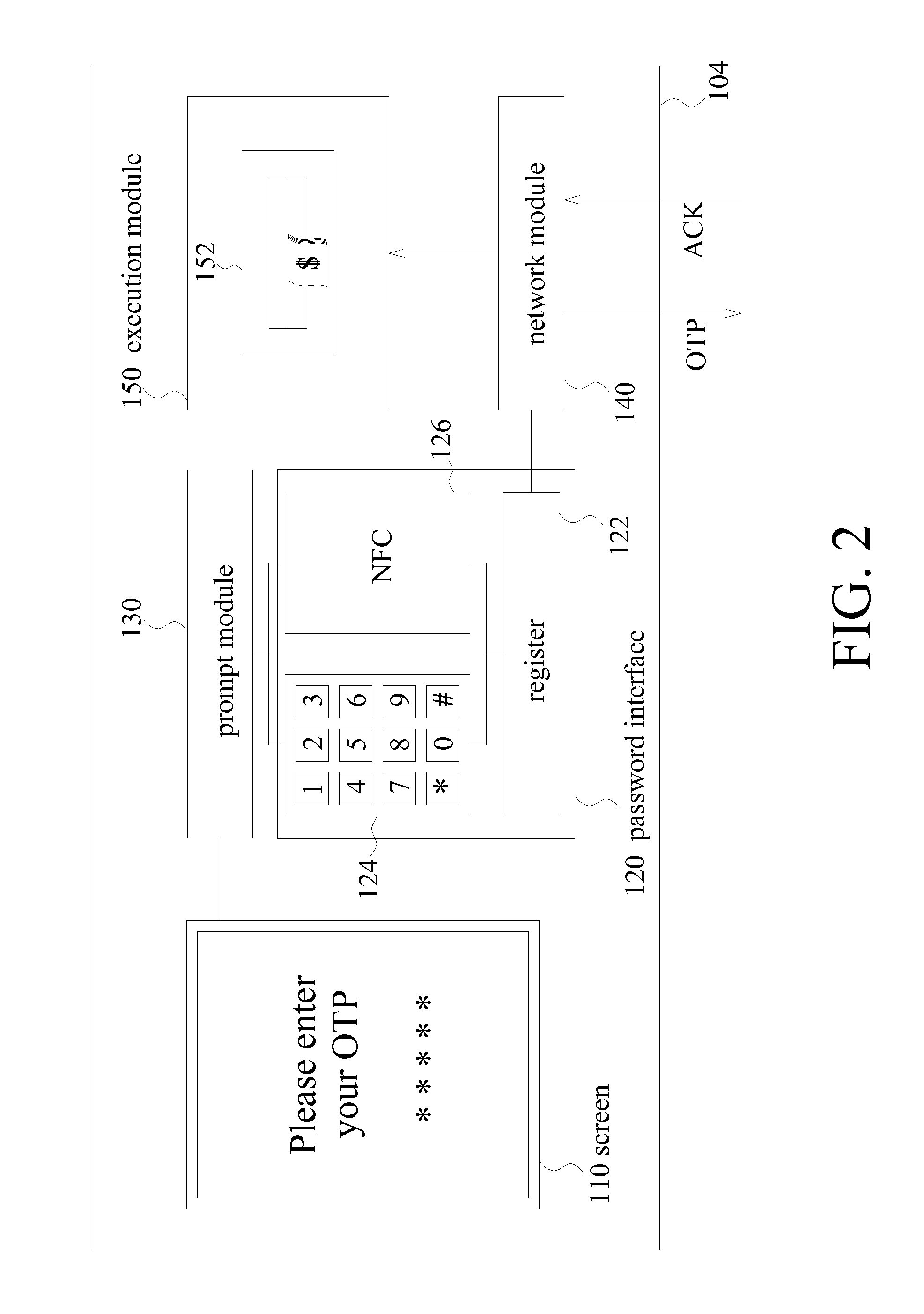

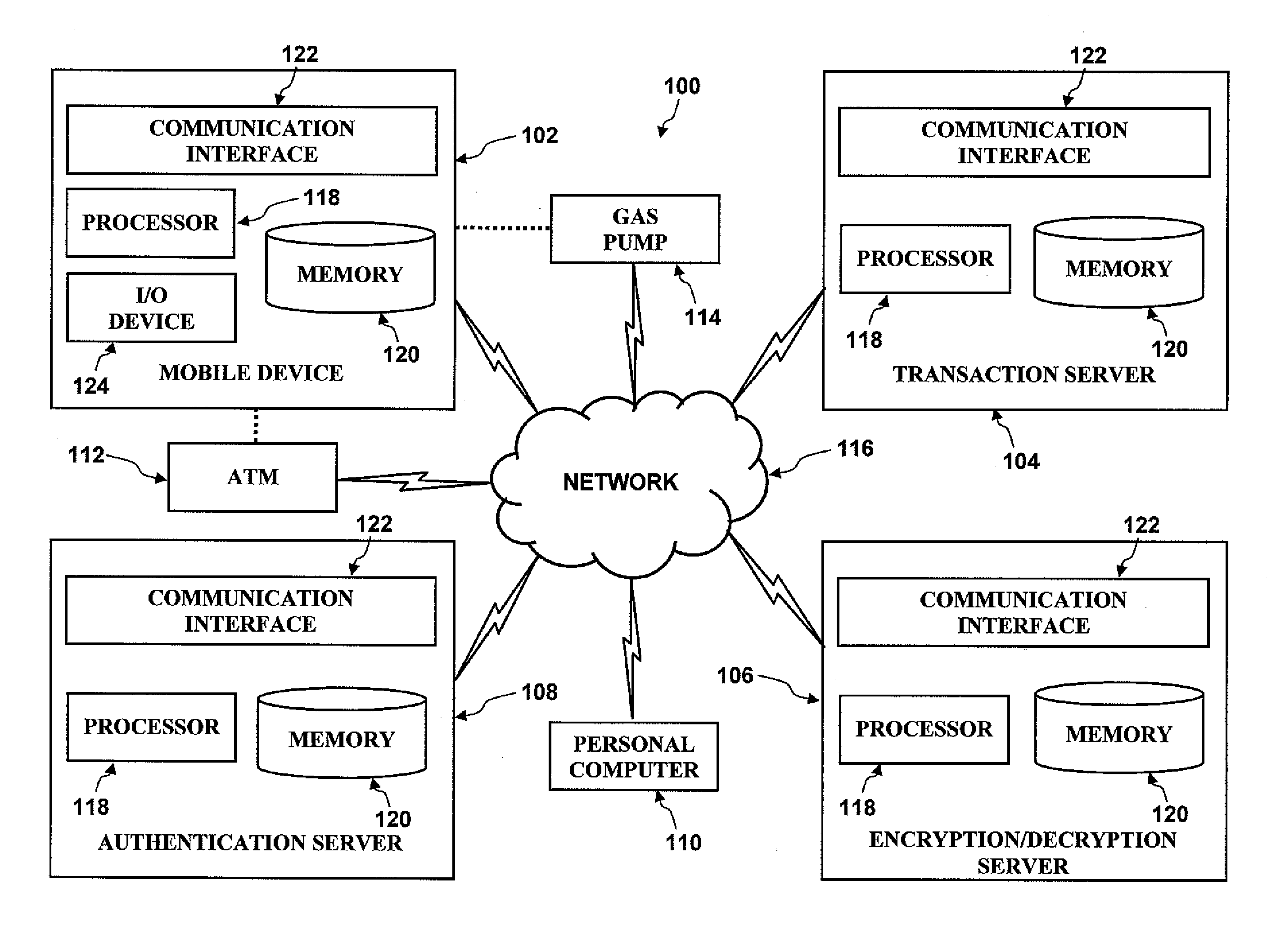

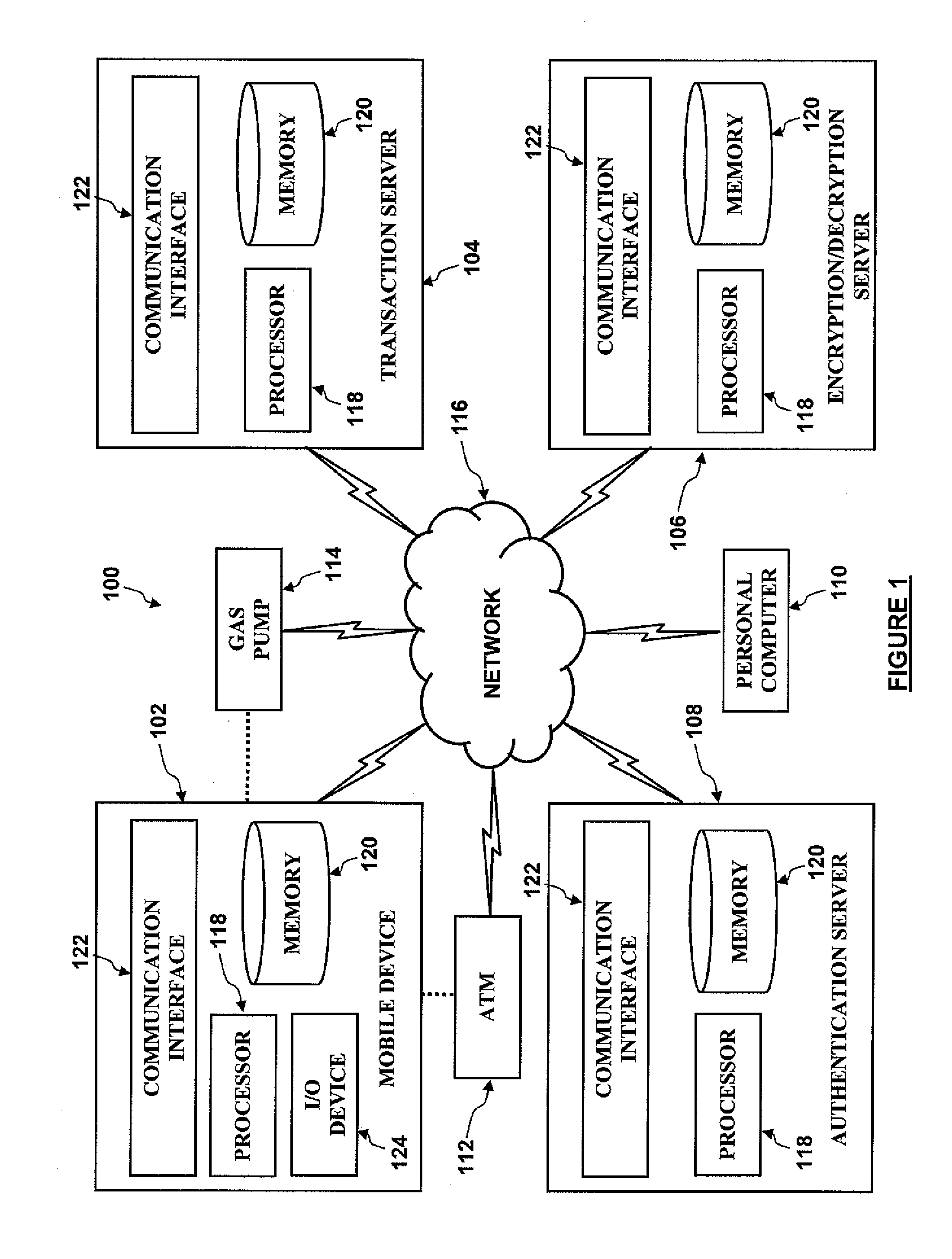

Financial transaction system, automated teller machine (ATM), and method for operating an ATM

InactiveUS20110016047A1Improve transaction securityImprove securityFinanceAutomatic teller machinesFinancial transactionFinancial trading

A financial transaction system is provided. The financial transaction system includes a server and at least one automated teller machine (ATM). In response to a request from a user, the server issues a one-time password (OTP) to the user's mobile device. The ATM receives an OTP from the user and sends the received OTP to the server for verification, in order to perform a financial transaction operation.

Owner:MIXTRAN INC

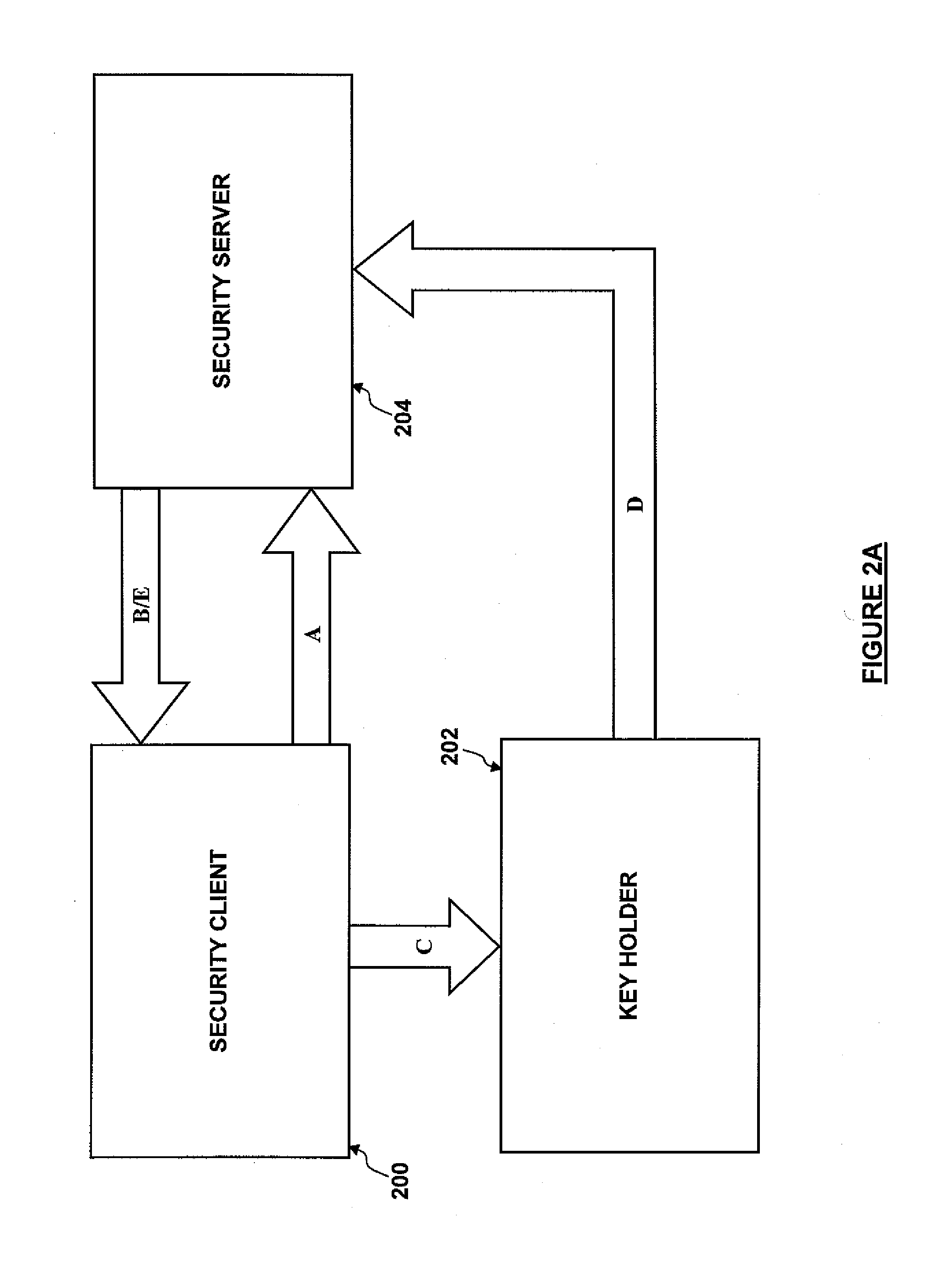

Automated banking machine component authentication system and method

ActiveUS7121460B1Increased resistenceAvoid modificationComplete banking machinesAcutation objectsComputer hardwareAuthentication system

An automated banking machine is provided which includes a first component and a second component. The first component is operative generate a first hash of a first identity data and a public key associated with the second component. The first component is operative to encrypt a randomly generated secret key using the public key associated with the second component. The second component is operative to receive at least one message from the first component which includes the encrypted secret key and the first hash. The second component is operative to decrypt the secret key with a private key that corresponds to the public key. The second component is operative to permit information associated with a transaction function to be communicated between the first and second components which is encrypted with the secret key when the first hash is determined by the second component to correspond to the first component.

Owner:DIEBOLD SELF SERVICE SYST DIV OF DIEBOLD NIXDORF INC

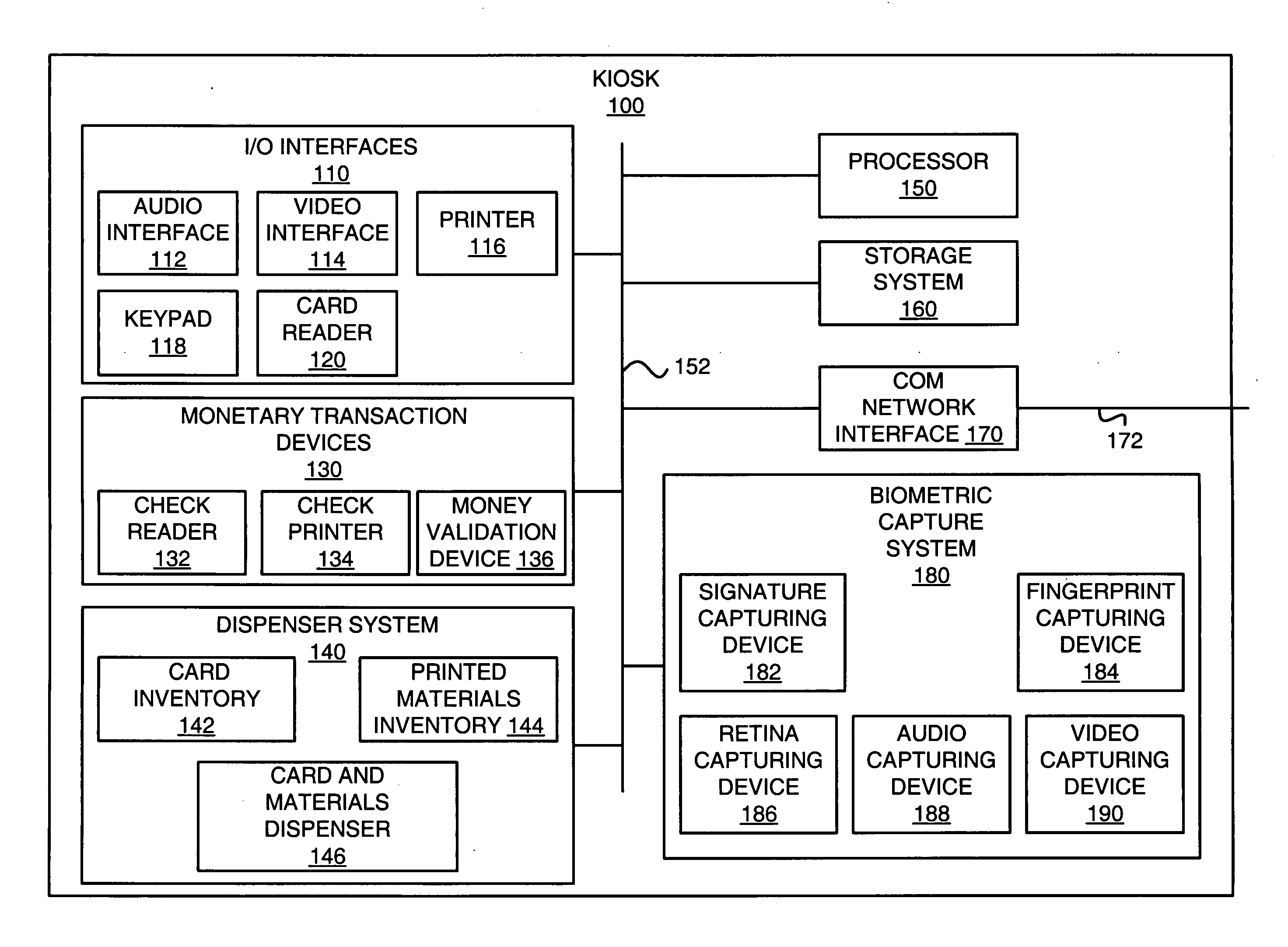

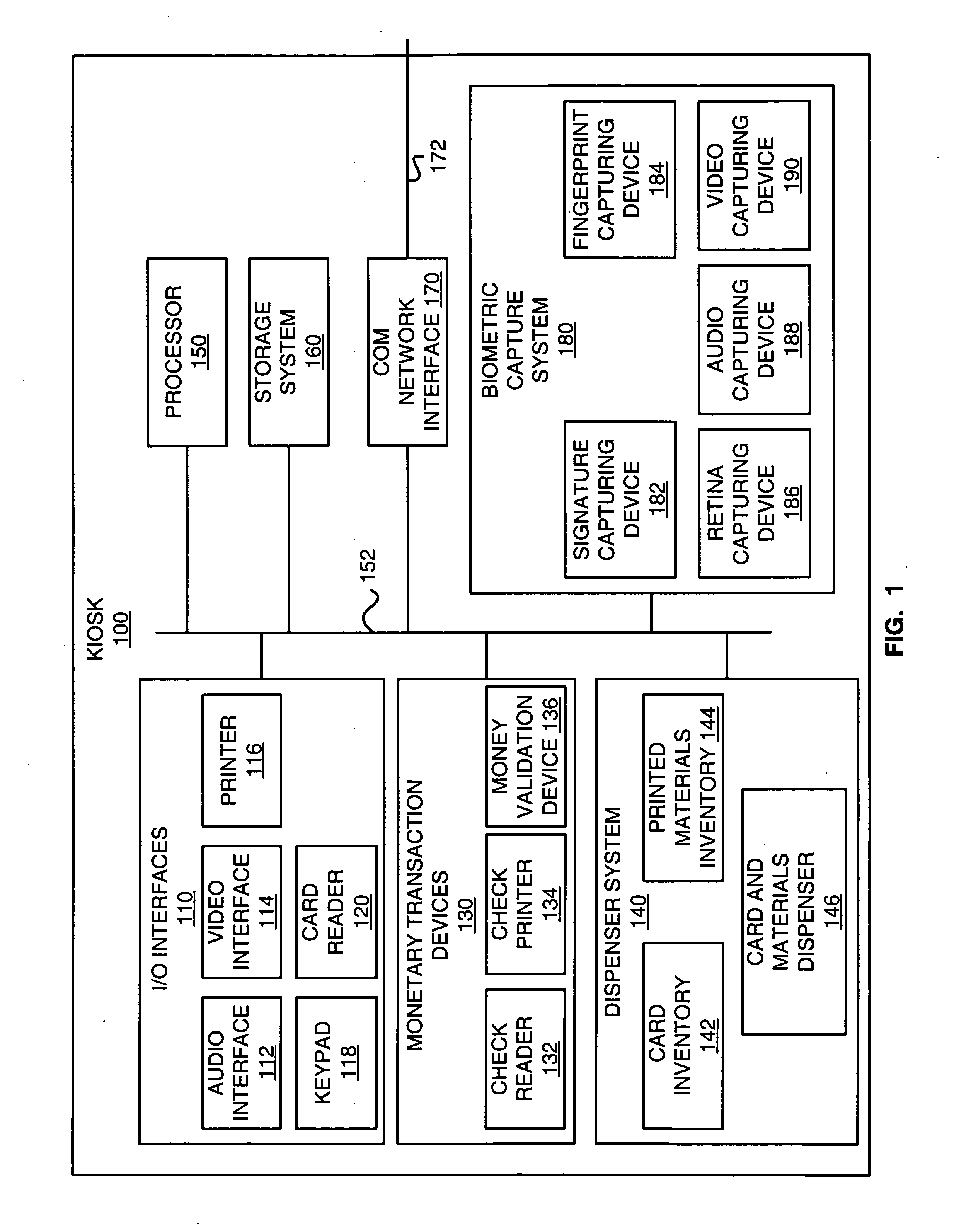

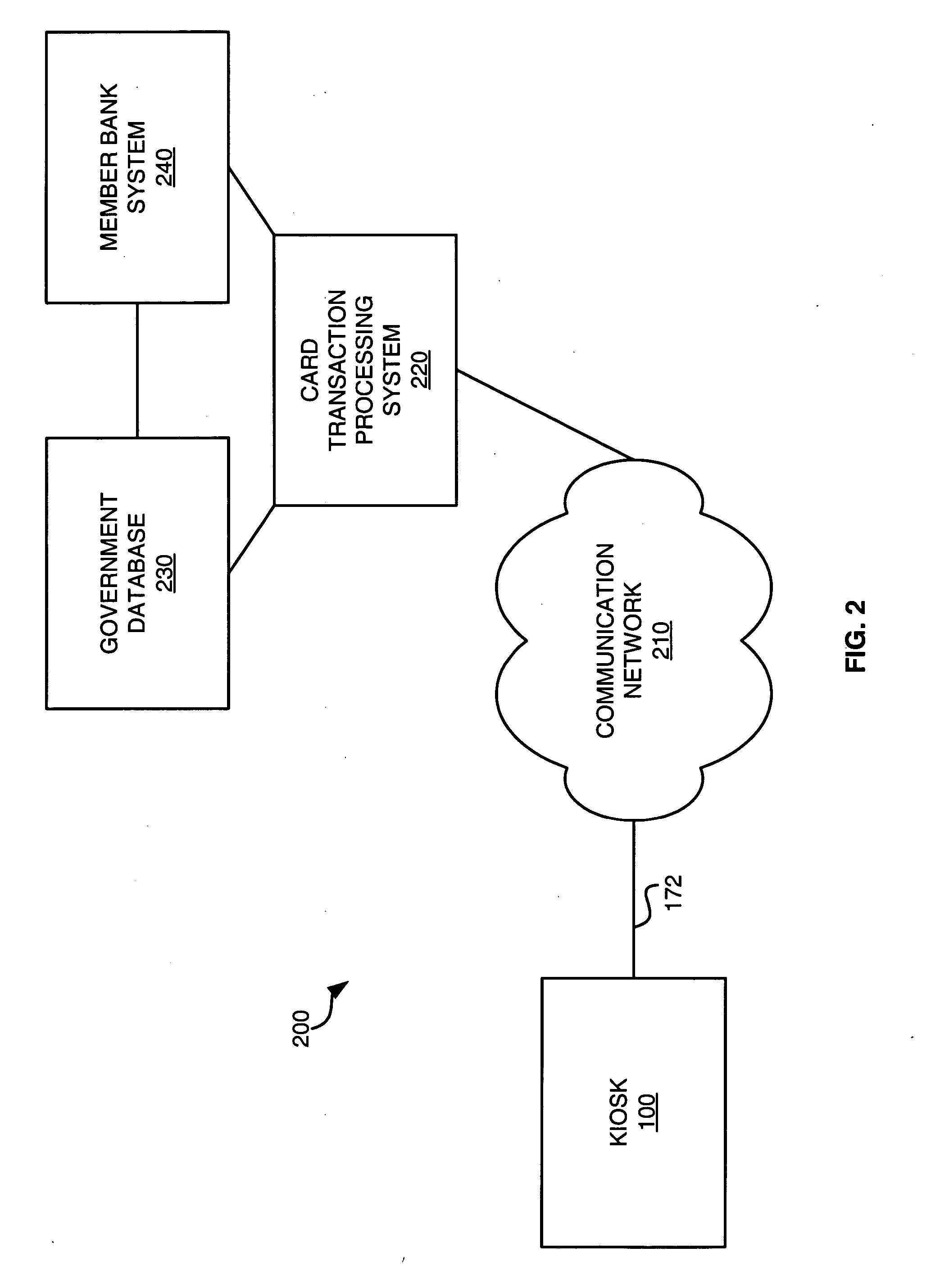

Kiosk systems and methods

A kiosk includes a front panel defining an opening in a body and an interactive screen positioned within the opening. A moisture resistant support structure is disposed between the front panel and the interactive screen. A central processing unit is disposed within the body and the central processing unit is operatively connected to the interactive screen.

Owner:RYKO MFG

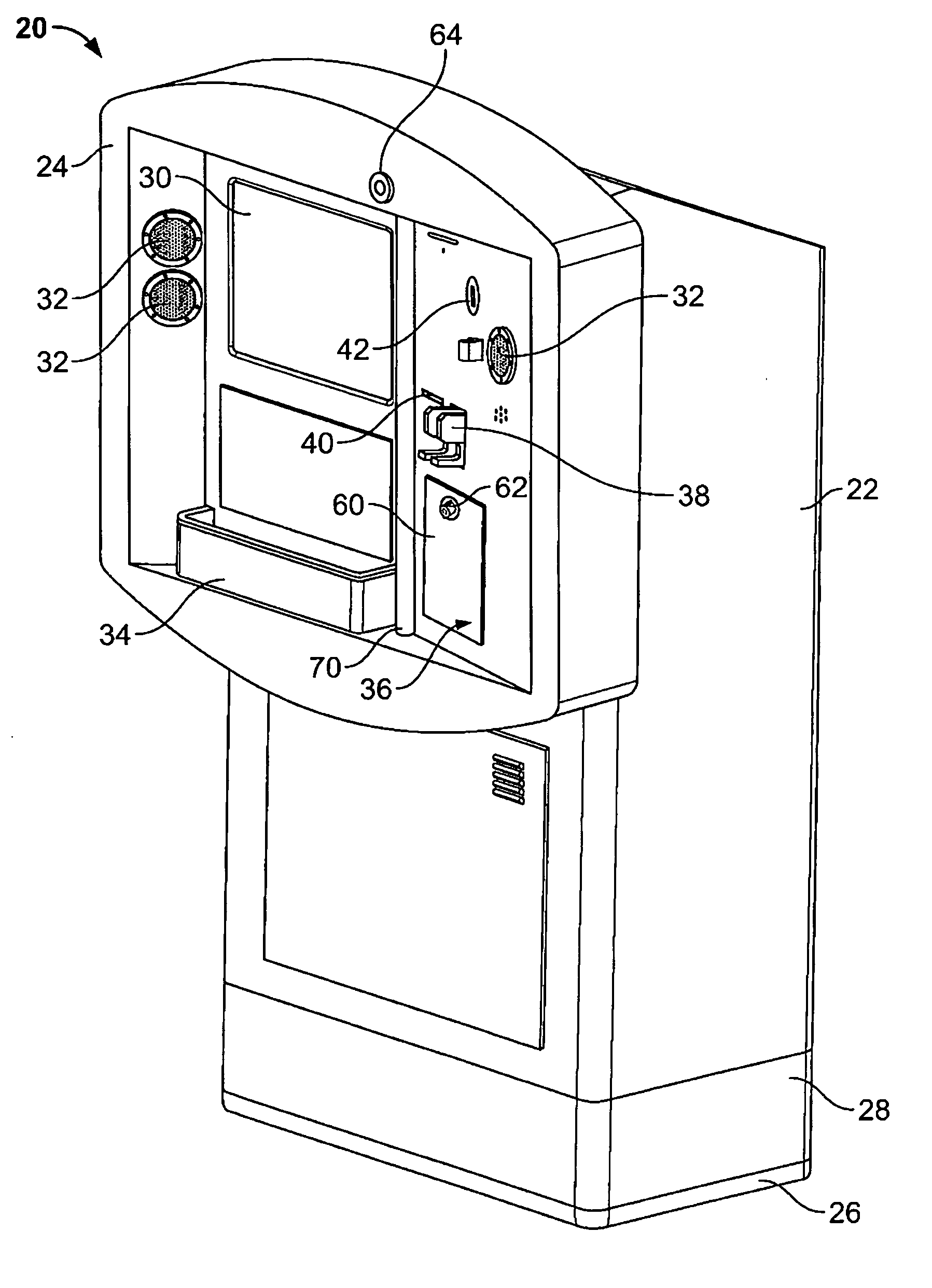

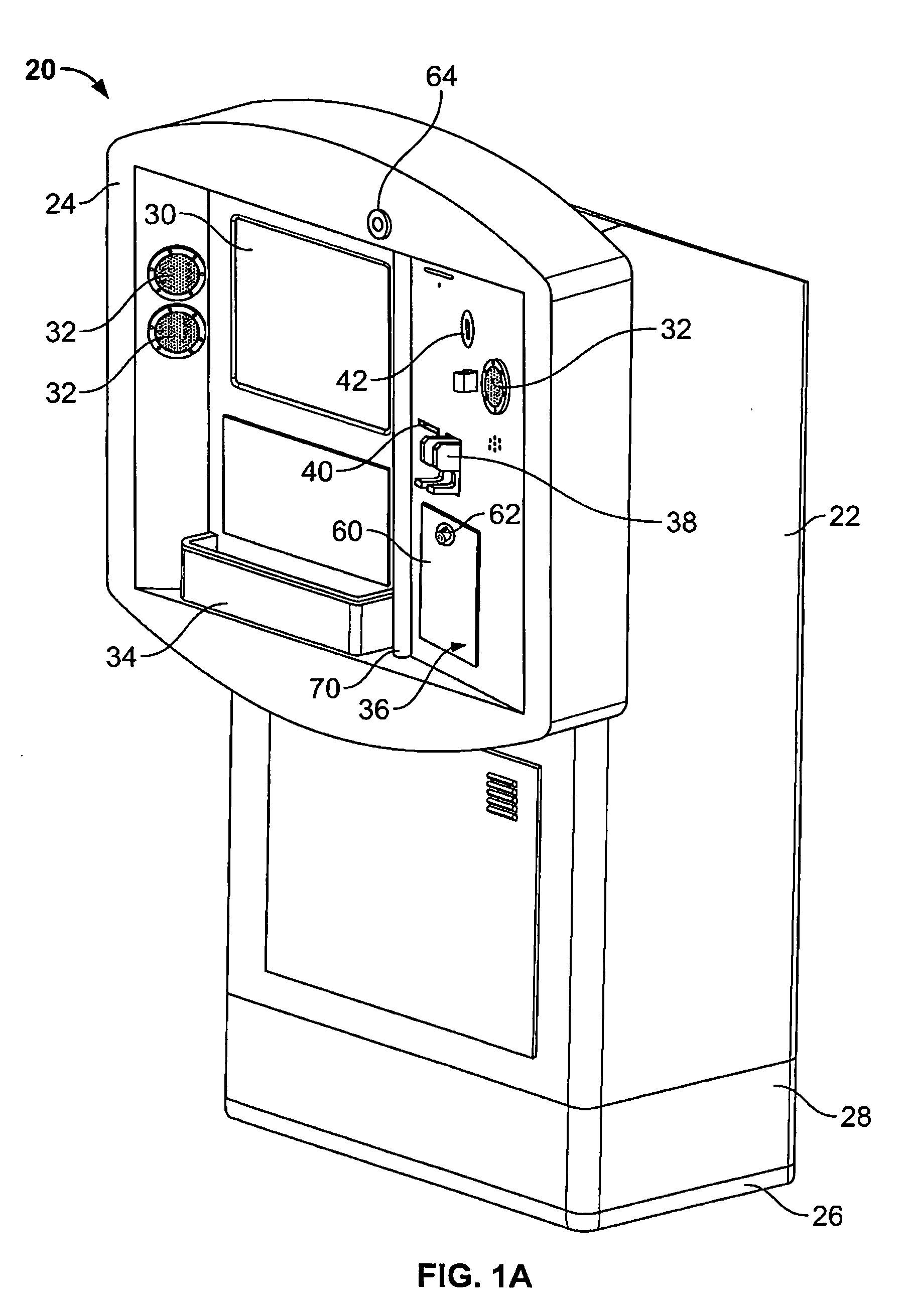

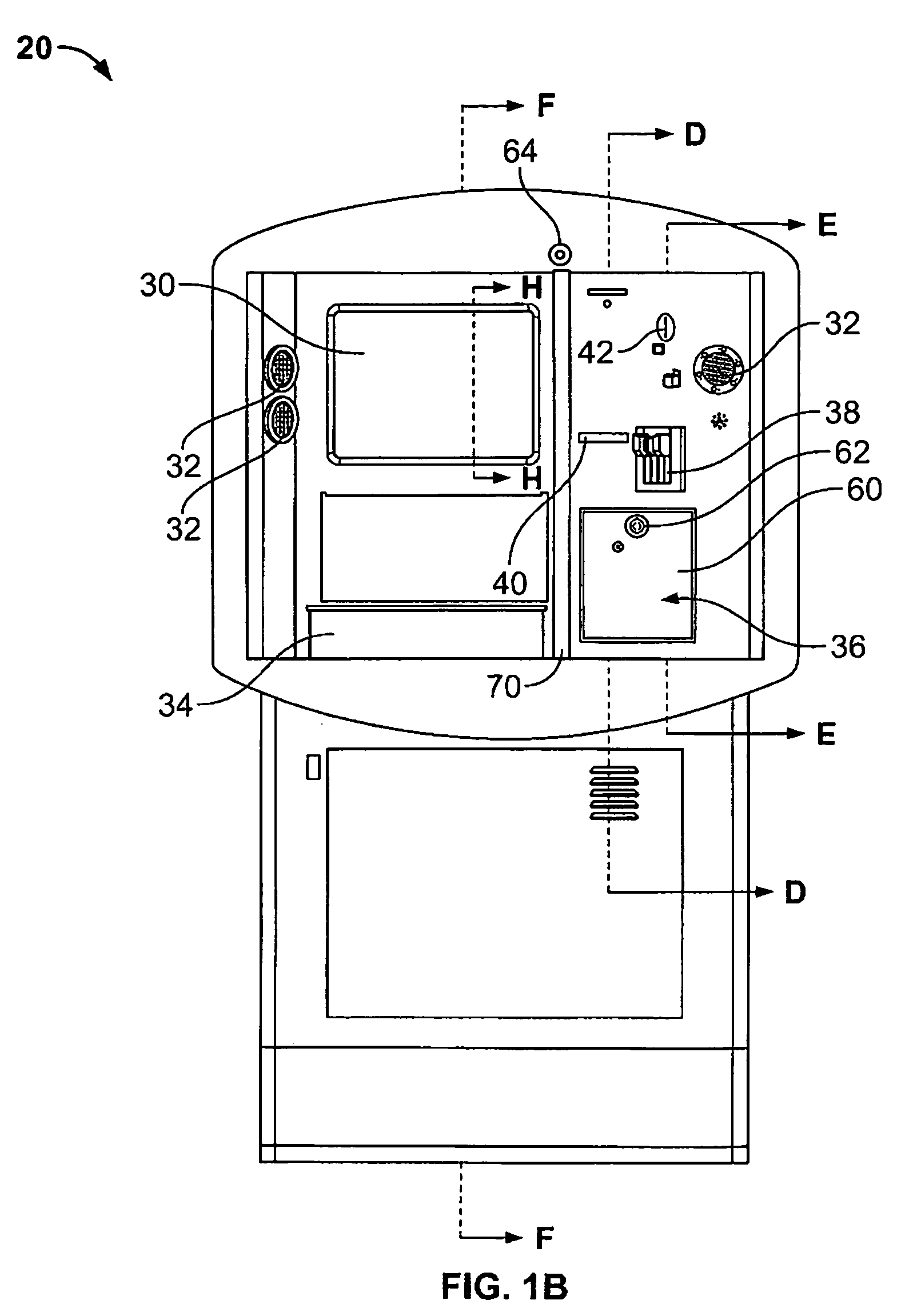

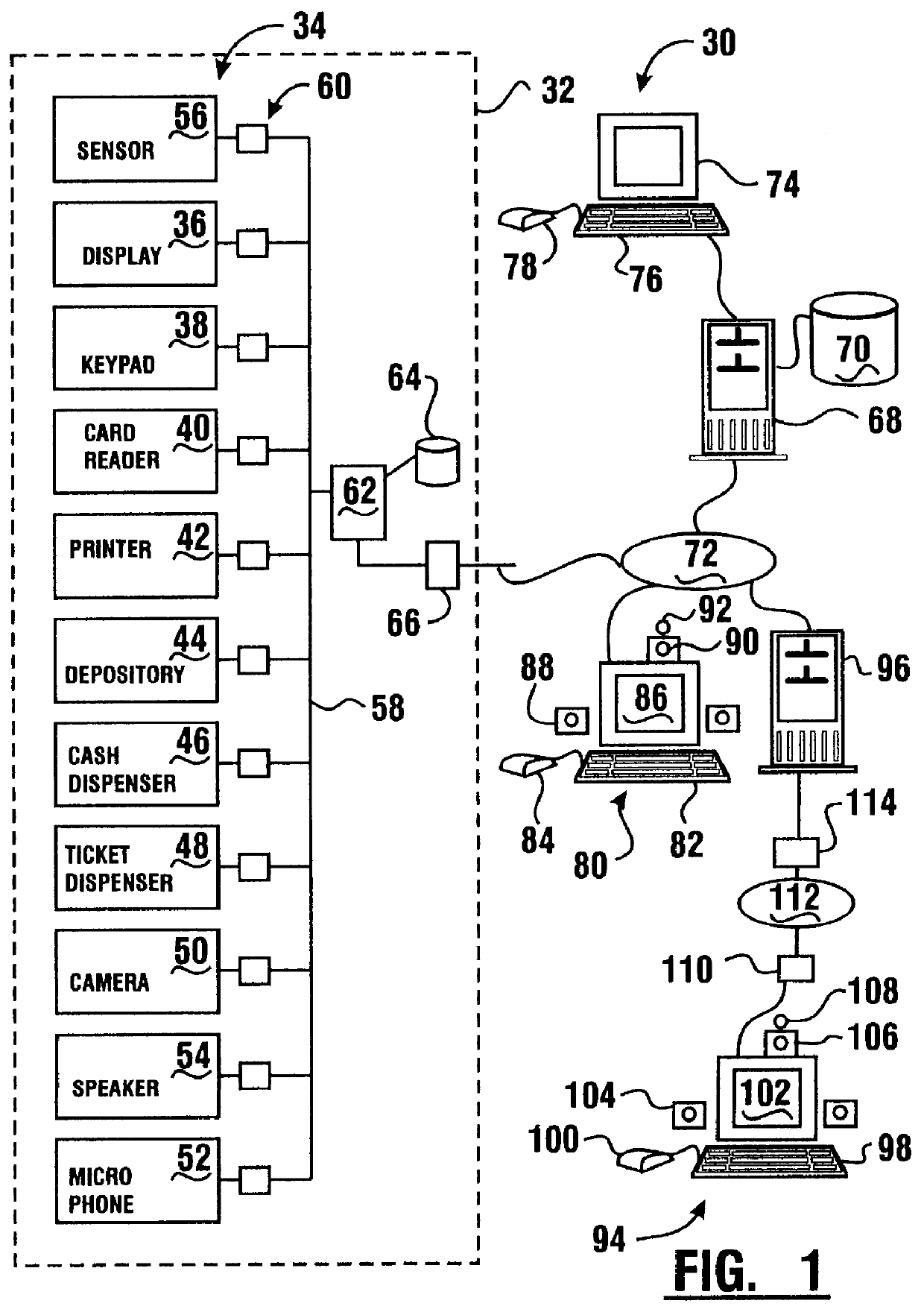

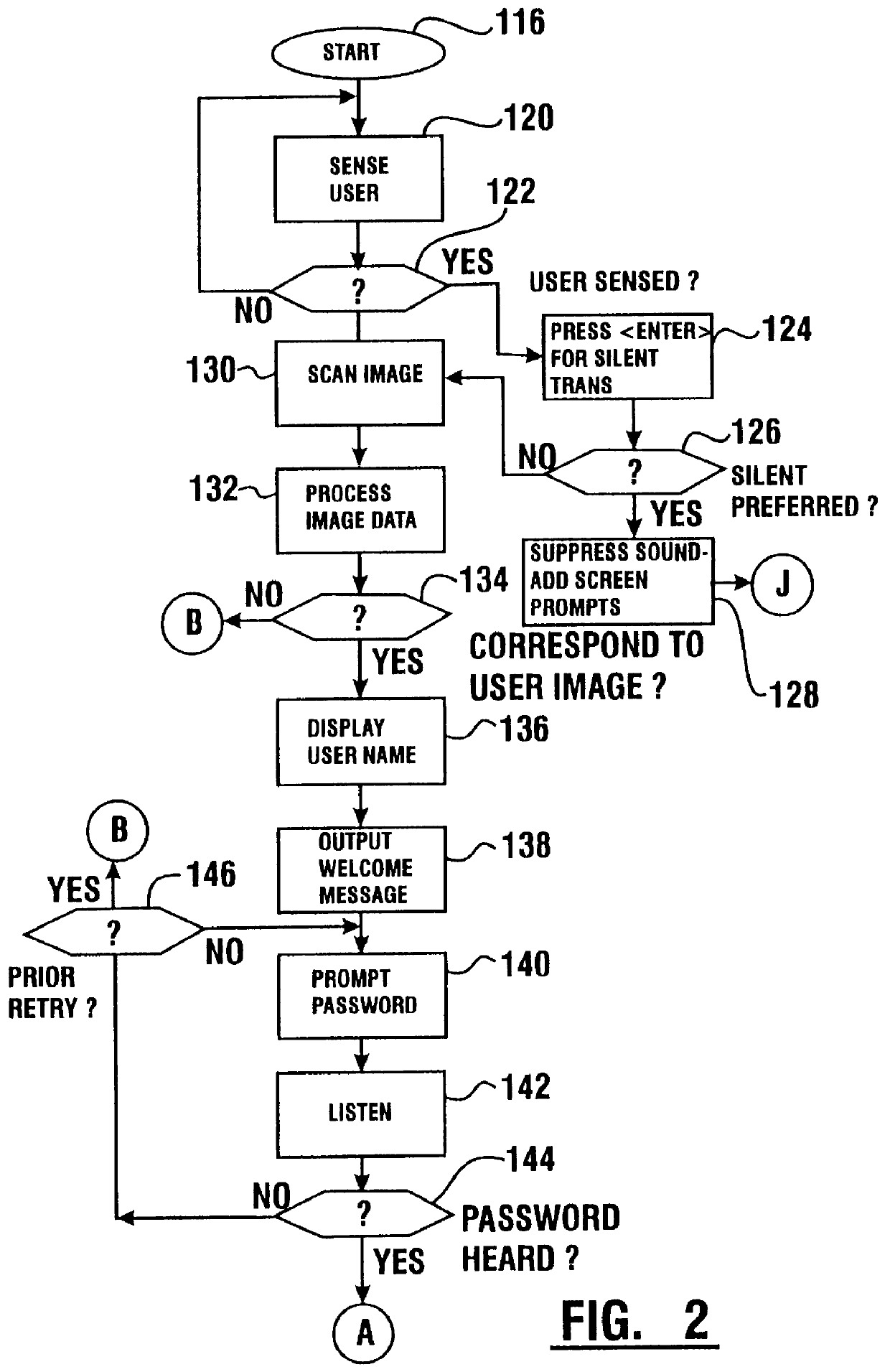

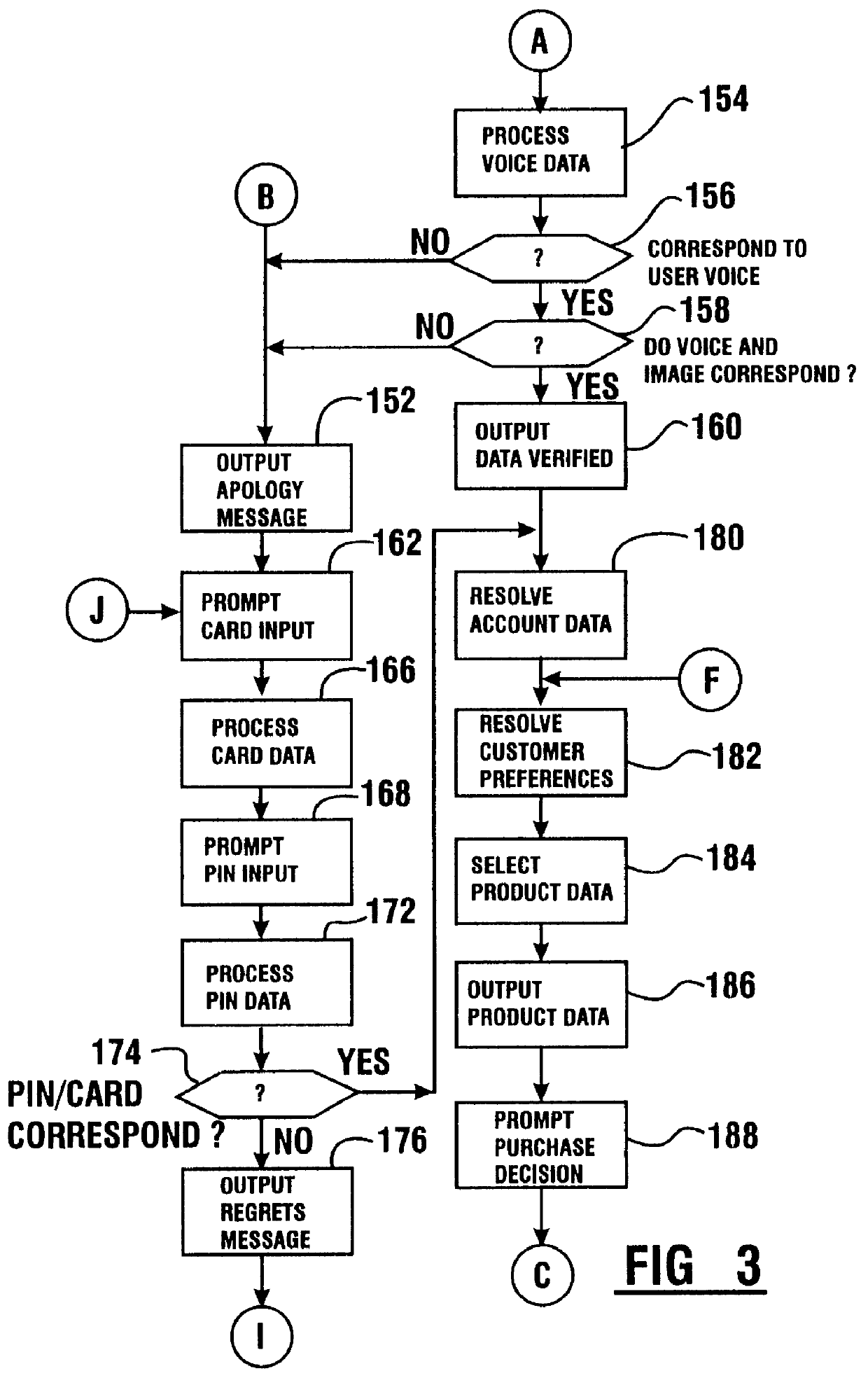

Transaction apparatus and method that identifies an authorized user by appearance and voice

A financial transaction apparatus (30) includes a financial transaction machine (32). The machine includes devices (34) including transaction function devices (42, 44, 46, 48) for carrying out operations associated with financial transactions. The terminal also includes an imaging device (50) and an audio input device (52), as well as a visual output device (36) and an audio output device (54). Terminal (32) is connected to a computer (68) which has an associated data store (70). The data store includes user data including image data and voice data corresponding to authorized users. The identity of a customer operating the machine is determined by resolving first identity data based on image signals from the imaging device which correspond to a user's appearance. Second identity data is resolved by the processor from voice signals from the audio input device corresponding to the user's voice. The computer enables operation of the transaction function devices if the level of correlation between the first and second identity data is sufficient to establish that the image and voice signals originate from a single authorized user.

Owner:DIEBOLD NIXDORF

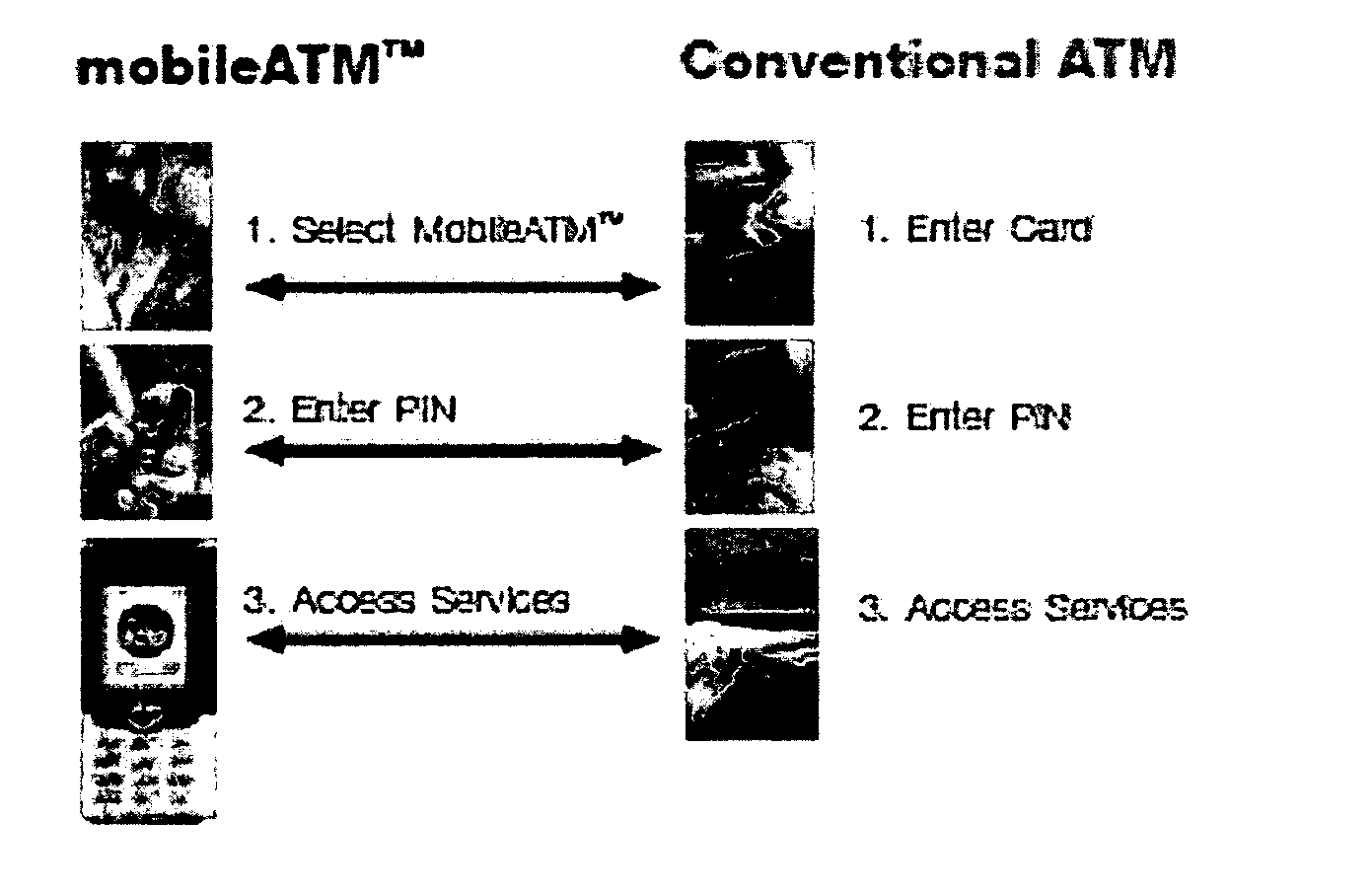

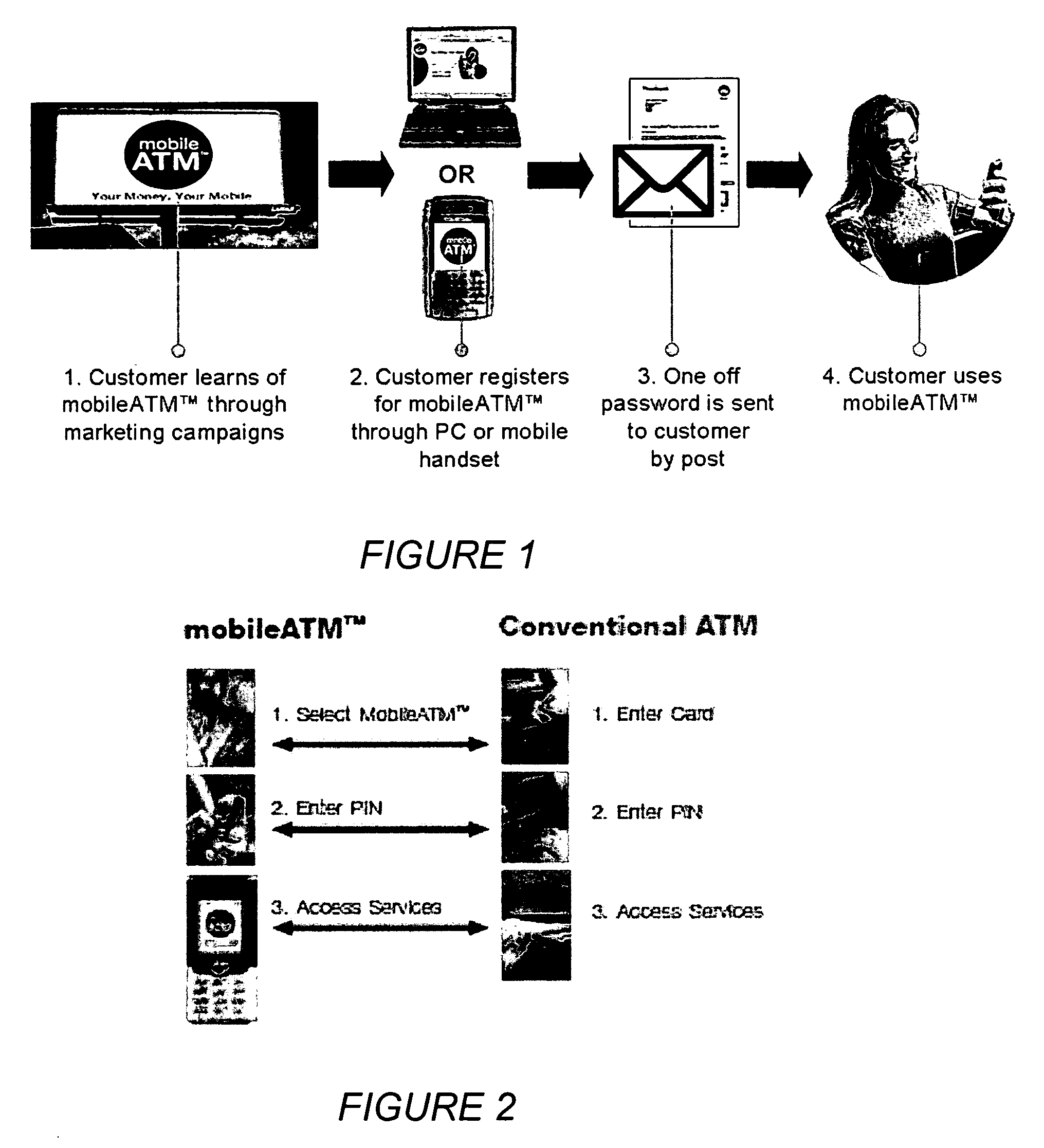

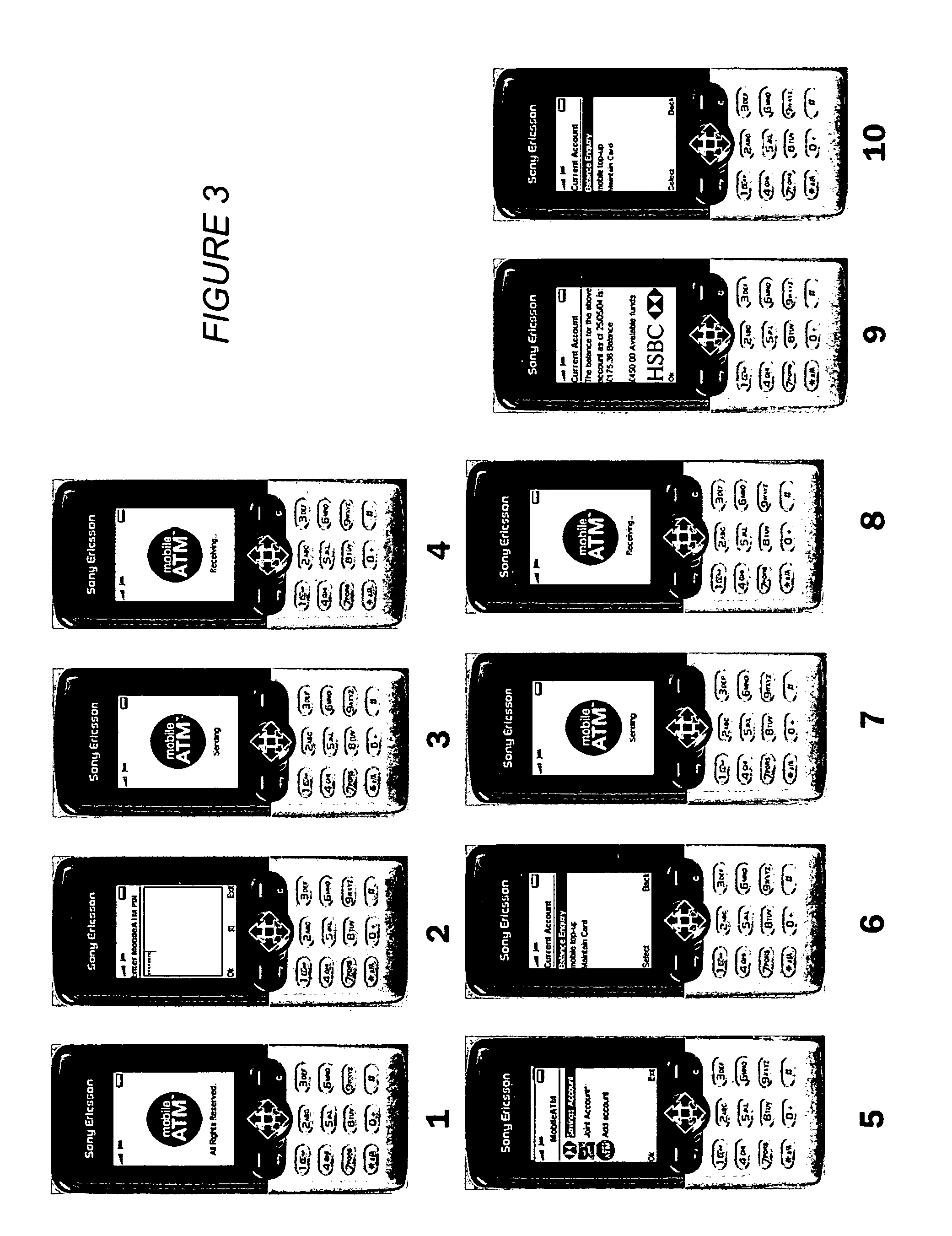

Electronic system for provision of banking services

ActiveUS20060136334A1Increased positional freedomWithout compromising securityComplete banking machinesFinanceElectronic systemsMobile telephony

An electronic system providing banking services, comprises a server having a first interface for communication with user mobile telephony devices over a mobile telephone network; and a second interface for communication with an intermediary acting as a gateway to banking records of multiple banking organisations. The first interface is adapted to allow at least balance enquiry requests to be submitted to one of the multiple banking organisations by means of the intermediary and to provide at least balance enquiry replies for display on the user mobile telephony device. The invention provides the functions of the high street ATM using the mobile phone environment.

Owner:FISERV

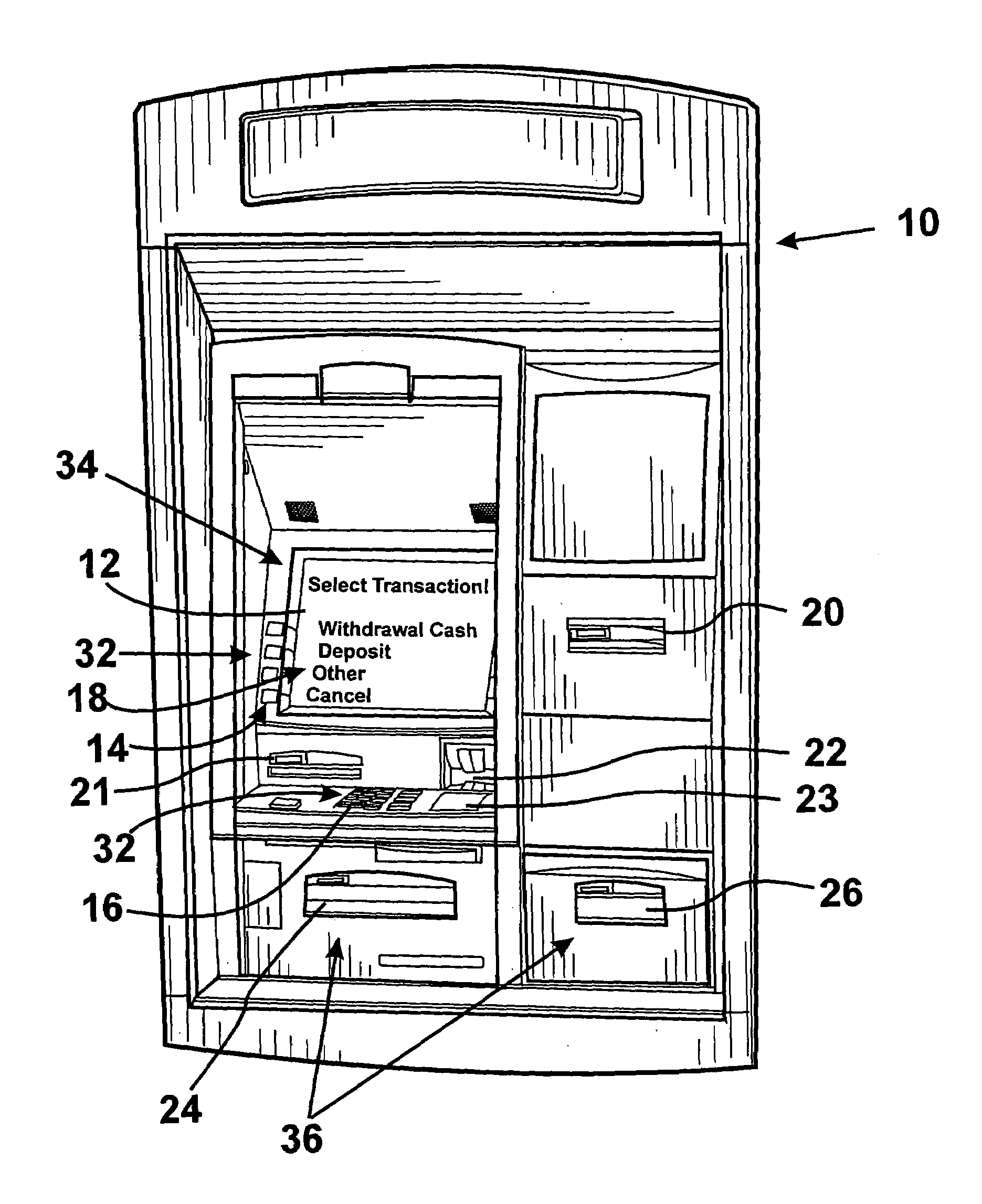

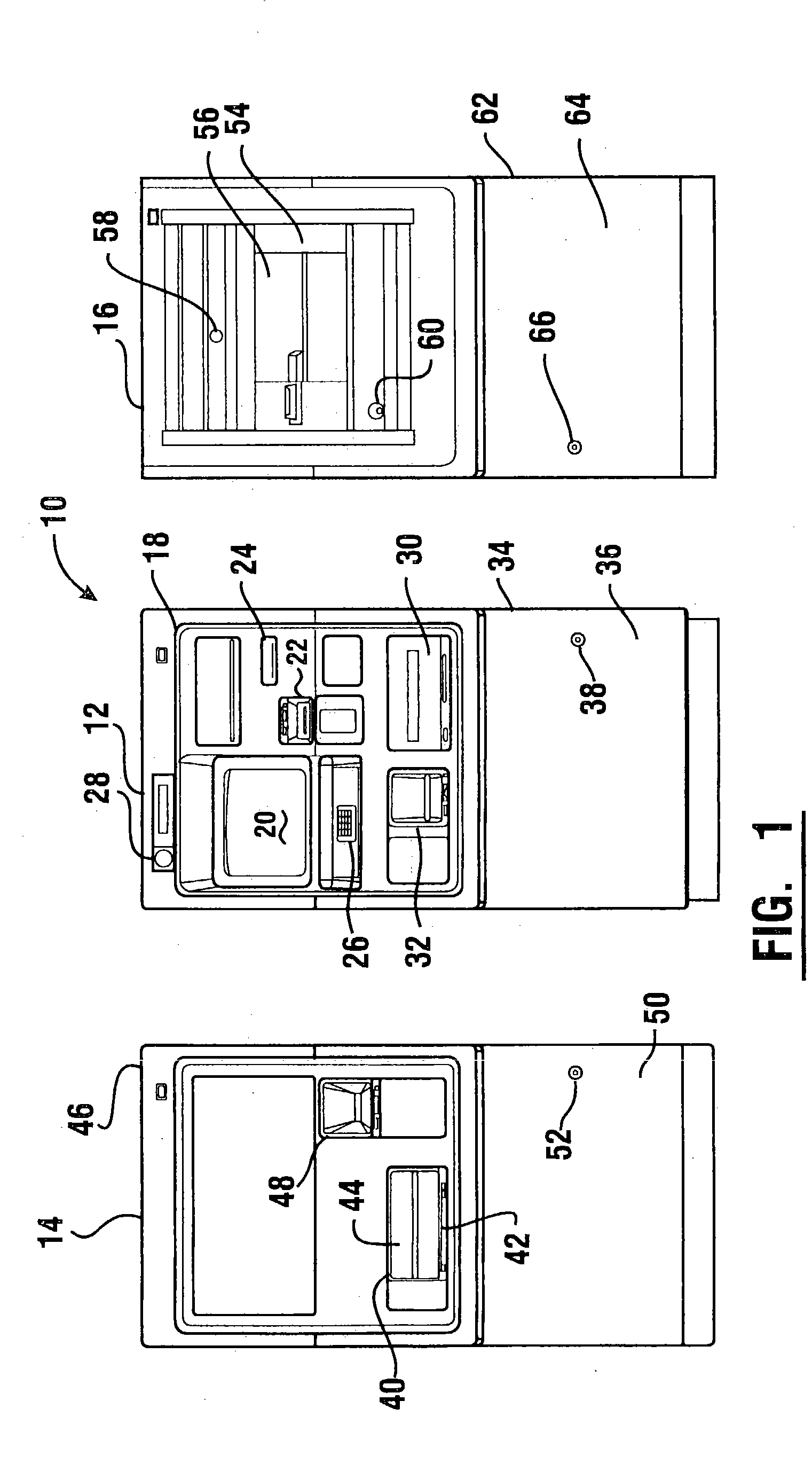

Automated banking apparatus and method

InactiveUS20040016796A1Accurate specificationsGood user interfaceComplete banking machinesCoin/currency accepting devicesFinancial transactionCheque

An automated banking apparatus is operative to carry out banking transactions commonly required by merchants. The apparatus includes an item accepting depository for accepting deposit items, such as deposit bags, currency, and checks. The apparatus further includes an input device that is operative to interrogate an RFID tag to obtain merchant deposit information therefrom. The information can include data representative of the deposit, such as an account number and the deposit amount. The RFID tag may be located on an item being deposited.

Owner:DIEBOLD NIXDORF

Using qr codes for authenticating users to atms and other secure machines for cardless transactions

ActiveUS20130124855A1Digital data processing detailsUser identity/authority verificationDisplay deviceAuthentication system

Systems, apparatus, methods, and computer program products for using quick response (QR) codes for authenticating users to ATMs and other secure machines for cardless transactions are disclosed. Embodiments of the present disclosure read an image displayed on a display of an external device using a mobile device associated with a user authorized to access a secure resource, decode transaction information encoded in the image, transmit the transaction information and an identifier of the mobile device from the mobile device to an authentication system, and grant access to the secure resource if the transaction information and the identifier satisfy an authentication test performed at the authentication system.

Owner:CA TECH INC

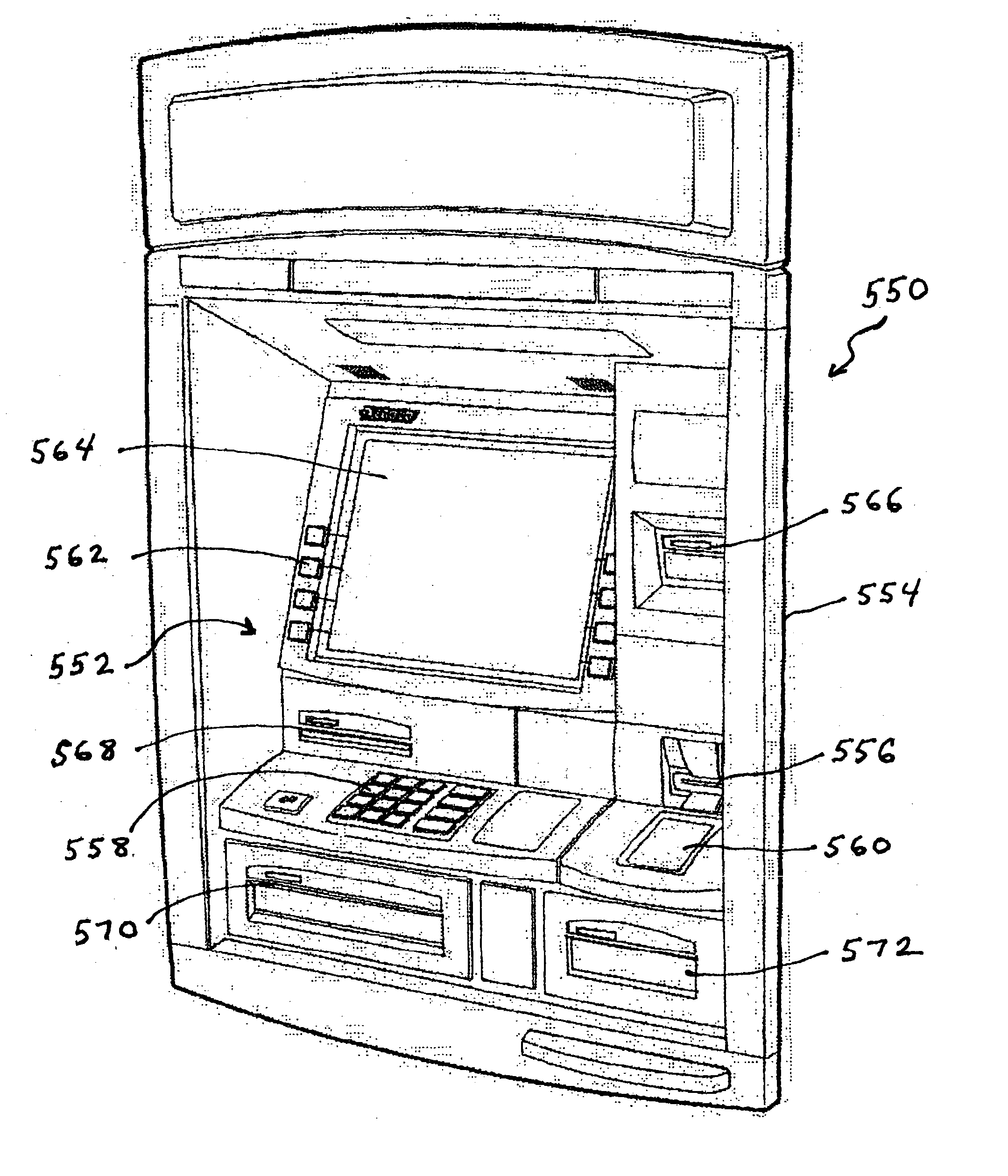

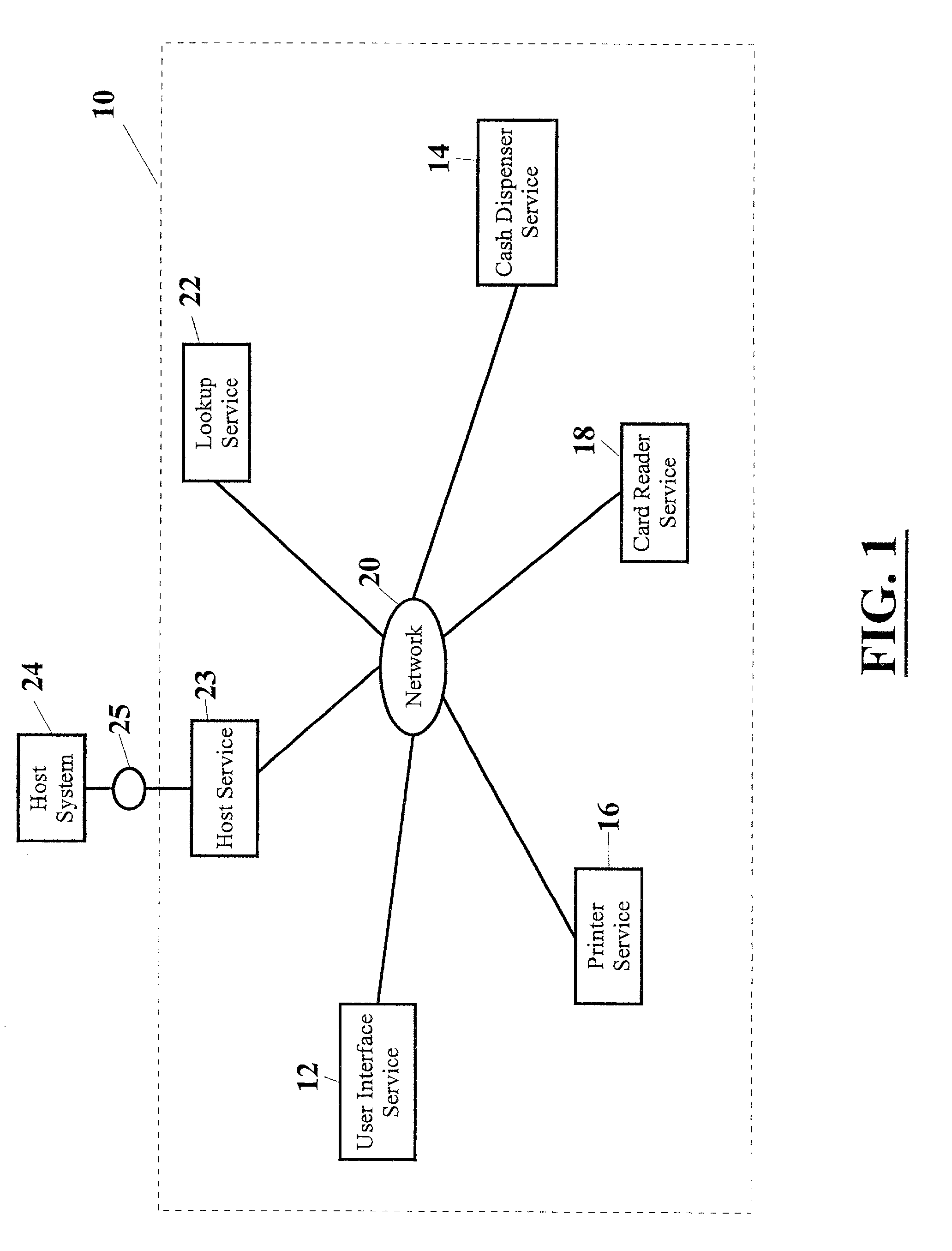

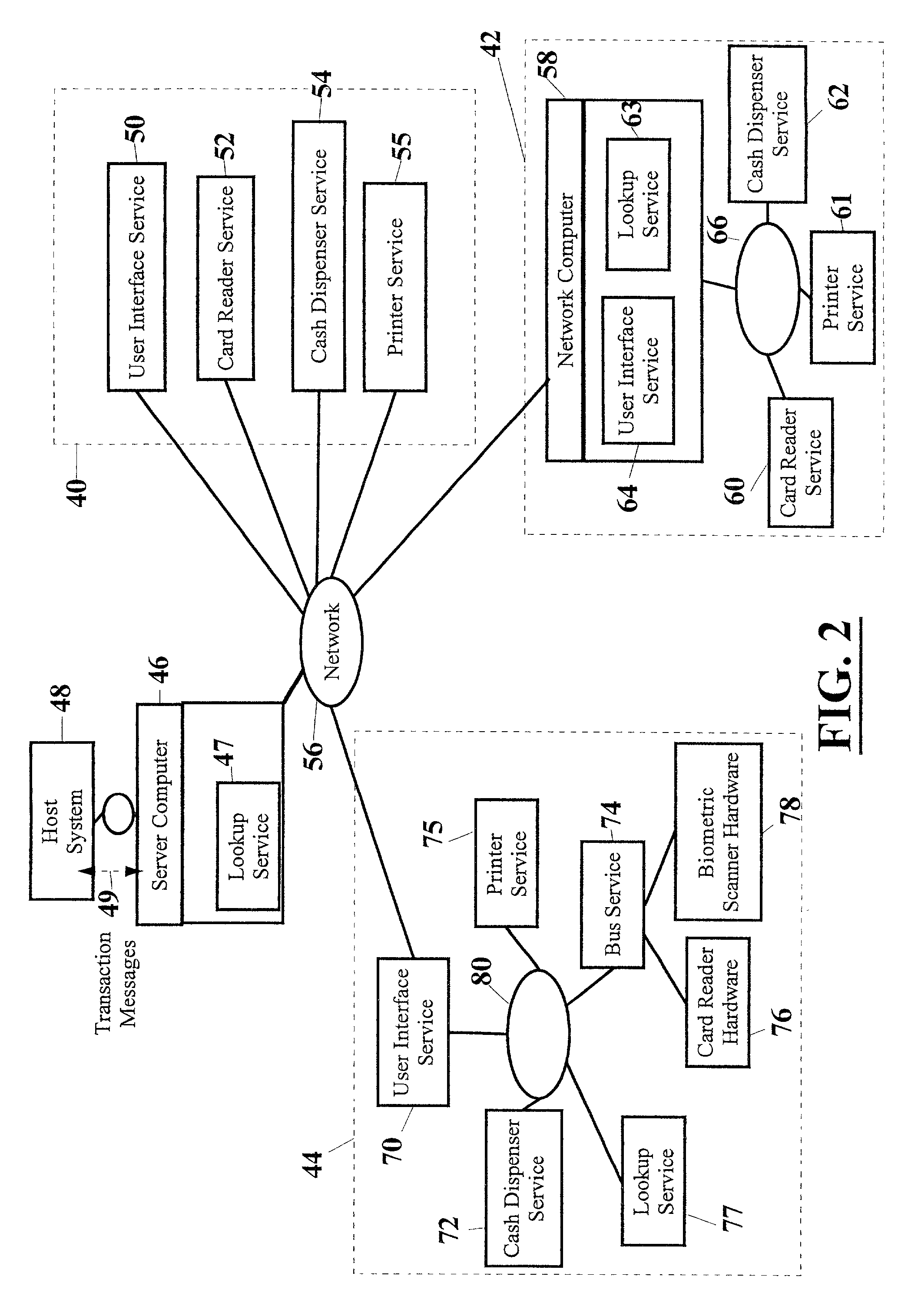

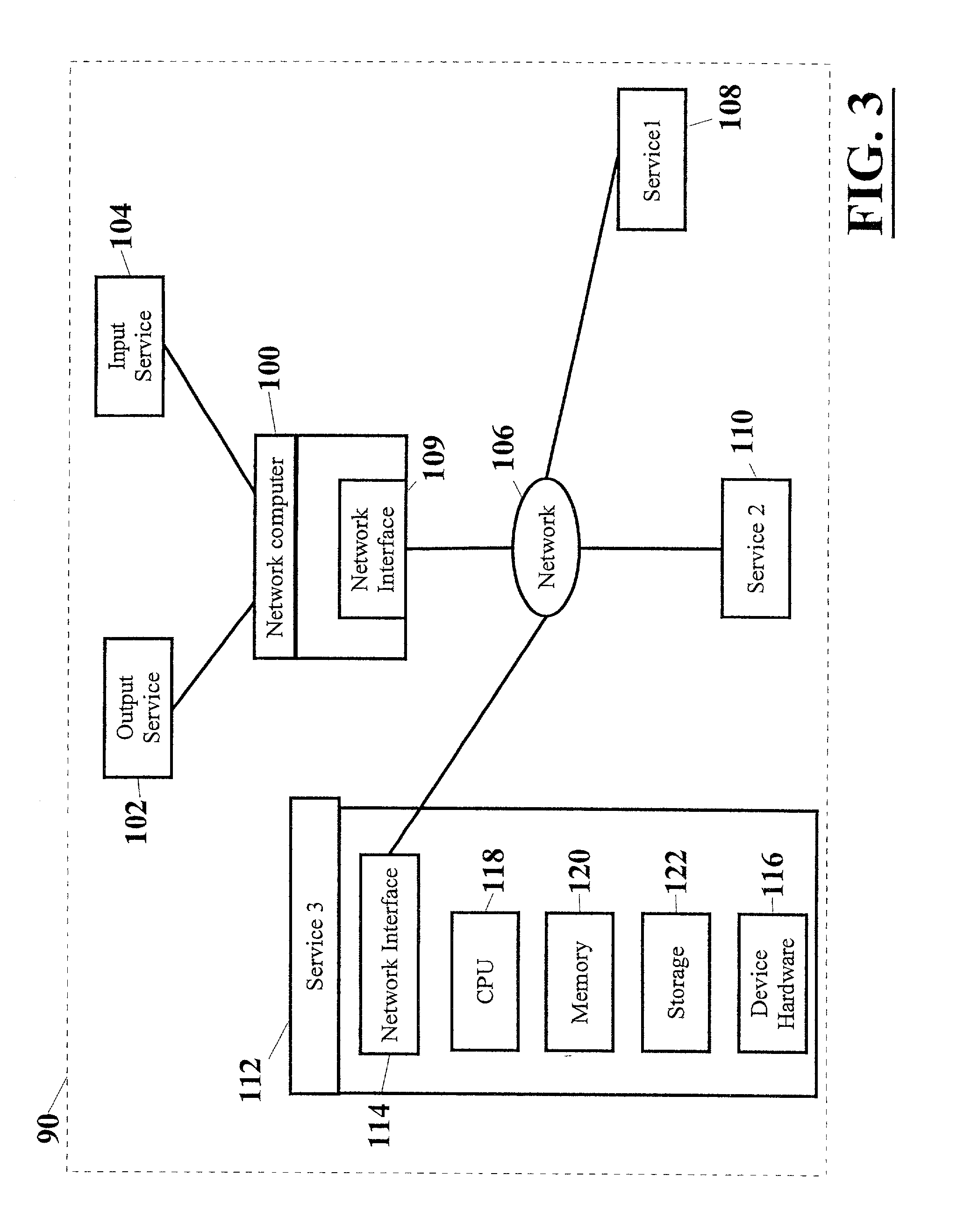

Automated transaction machine and method

InactiveUS20010014881A1Firmly connectedExtension of timeComplete banking machinesFinanceTransaction serviceCard reader

A system for connecting transaction services to an ATM (10, 500) that includes a network (20). A user interface service (12) and a lookup service (22) are in operative connection with the network. Transaction services such as a printer service (16), card reader service (18), and cash dispenser service (14) are also in operative connection with the network. These transaction services are operative to register with the lookup service and to upload a service proxy to the lookup service. The user interface service is operative to locate transaction services on the network by invoking a remote lookup method on the lookup service. The lookup service is operative to return service proxies that match the type of service that is required. The user interface service is further operative to invoke methods of the service proxies that remotely control the functionality of the transaction services on the network. The user interface service is further operative to register events with the service proxies for notification when certain events on the services occur.

Owner:DIEBOLD NIXDORF

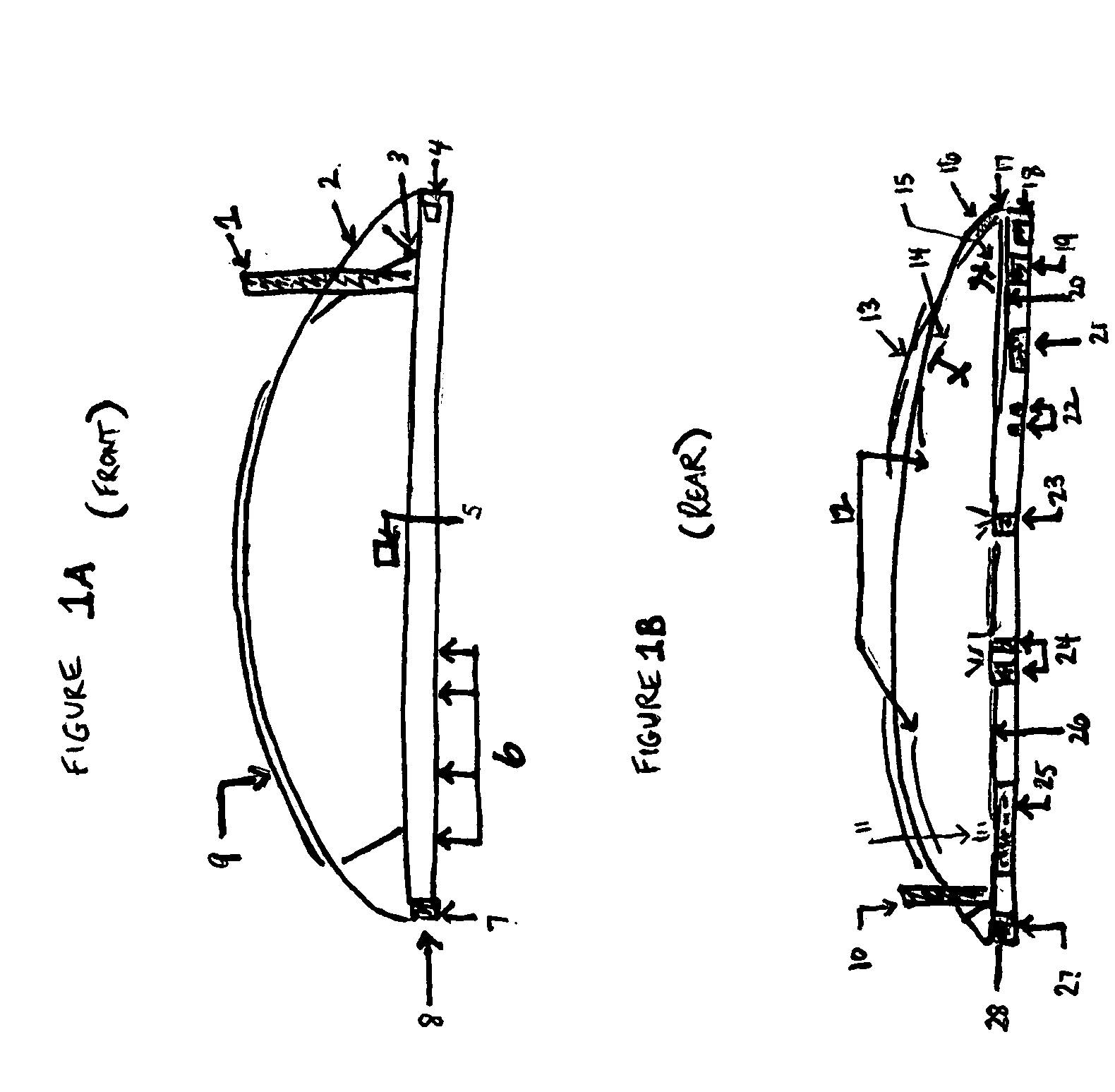

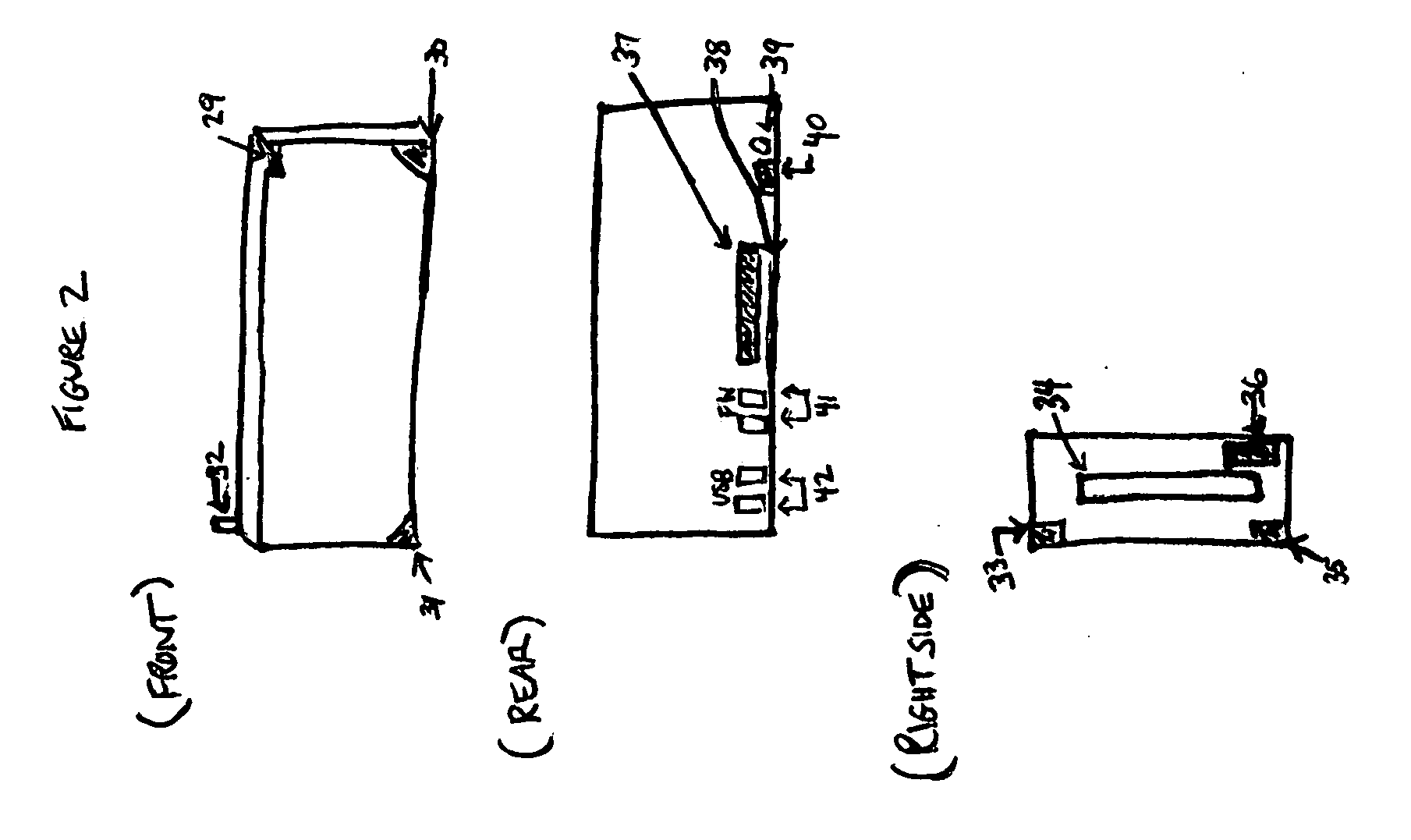

Multi-account card with magnetic stripe data and electronic ink display being changeable to correspond to a selected account

A multifunction card includes a programmable memory, a magnetic stripe, and an electronic ink display. The programmable memory is able to store corresponding account data and image data for a plurality of different accounts. The card holder is able to use a portable terminal to select one of the accounts stored in memory. The terminal is able to write account data corresponding to the selected account to the magnetic stripe of the card. The terminal is also able to electronically change the electronic ink display to the image corresponding to the selected account. Thus, a single multifunction card, with the ability to have both its magnetic stripe data and appearance changed in accordance with a selected account, can substitute for many different cards.

Owner:DIEBOLD SELF SERVICE SYST DIV OF DIEBOLD NIXDORF INC

System and method for capturing and searching image data associated with transactions

InactiveUS7595816B1Increase valueGreat assuranceComplete banking machinesColor television detailsPattern recognitionData pack

A system and method for capturing image data captures images responsive to programmed sequences. The sequences are performed on a periodic basis as well as in response to inputs corresponding to alarm conditions and transactions conducted at automated banking machines or other devices. Image data may also be captured in response to image conditions including the sensing of motion or the loss of usable video from selected cameras. Image data is stored in connection with data corresponding to circumstances associated with each triggering event. Stored image data may be searched by one or more parameters. Parameters include data stored in association with each image, types of events causing image data to be stored, as well as other image conditions in stored images.

Owner:DIEBOLD NIXDORF

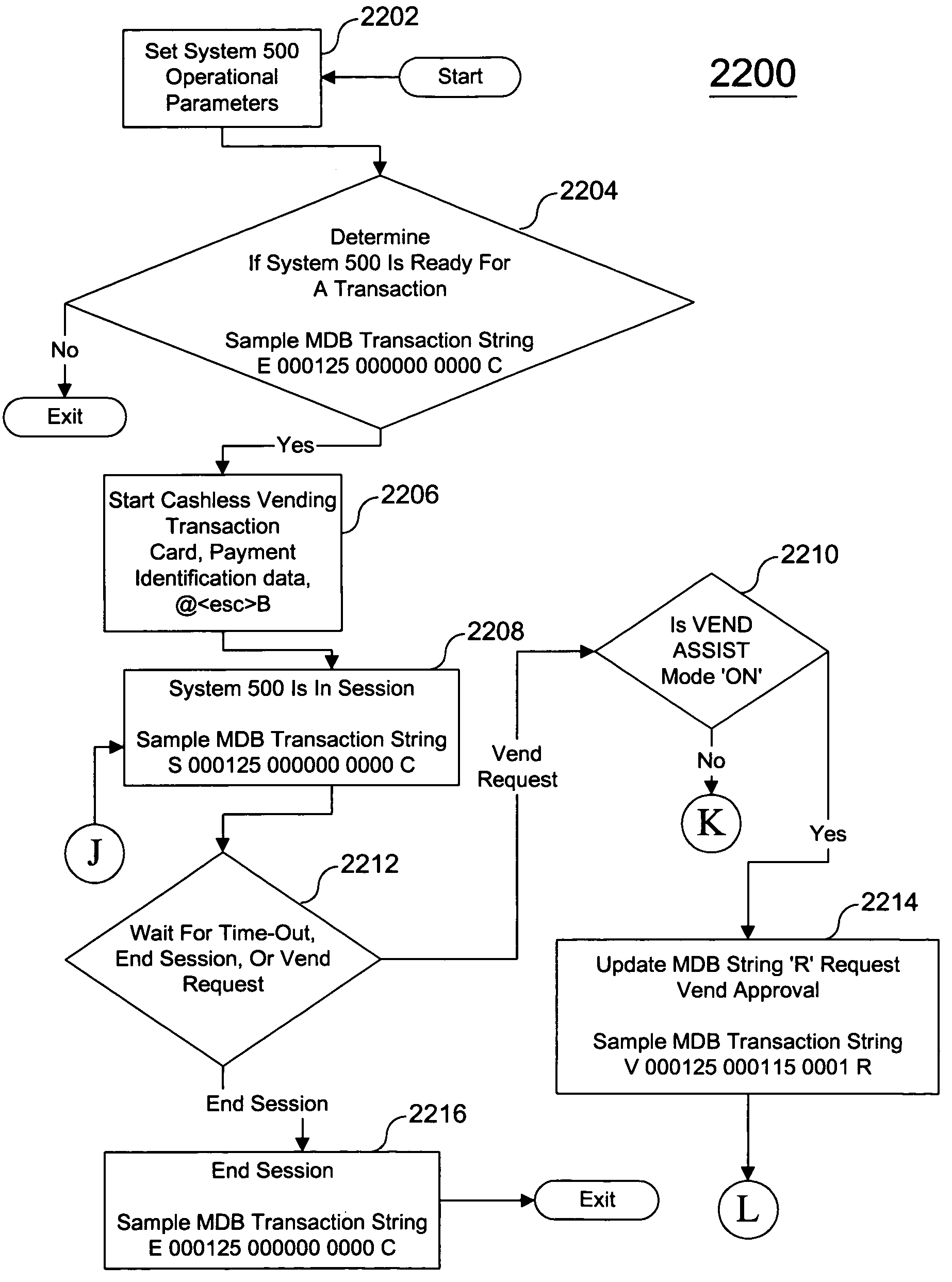

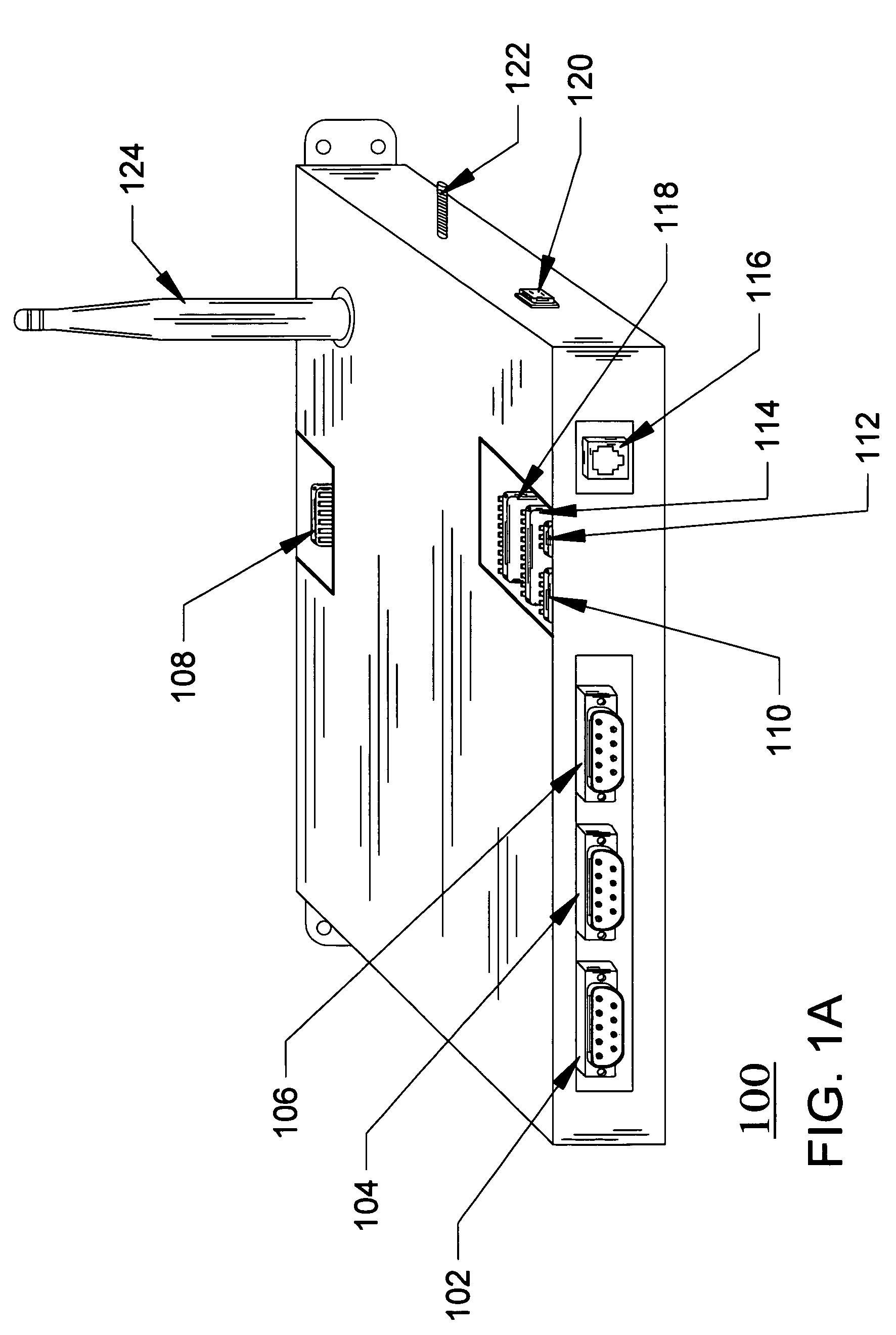

Cashless vending transaction management by a vend assist mode of operation

InactiveUS7076329B1International currency conversion processing fees are minimizedApparatus for meter-controlled dispensingAutomatic teller machinesPaymentTransaction management

The present invention relates to a cashless transaction processing system implementing a VEND ASSIST mode of operation to effectuate a cashless vending transaction. The VEND ASSIST mode allows a computing platform 802 to oversee, control, and authorize by way of a system 500 the vend selection and sale price of a user selected vend item prior to fulfilling the user's request.The cashless transaction processing system includes a system 500 and a computing platform 802. The system 500 initiates a vending session when certain commands from an interconnected computing platform 802 are received or in response to presentation, by a user, of valid payment identification data. Computing platform 802 data communicates a VEND APPROVE or VEND DENY response to a system 500 initiated REQUEST VEND APPROVE data communication. A vend cycle is then initiated or preempted as appropriate.

Owner:CANTALOUPE INC

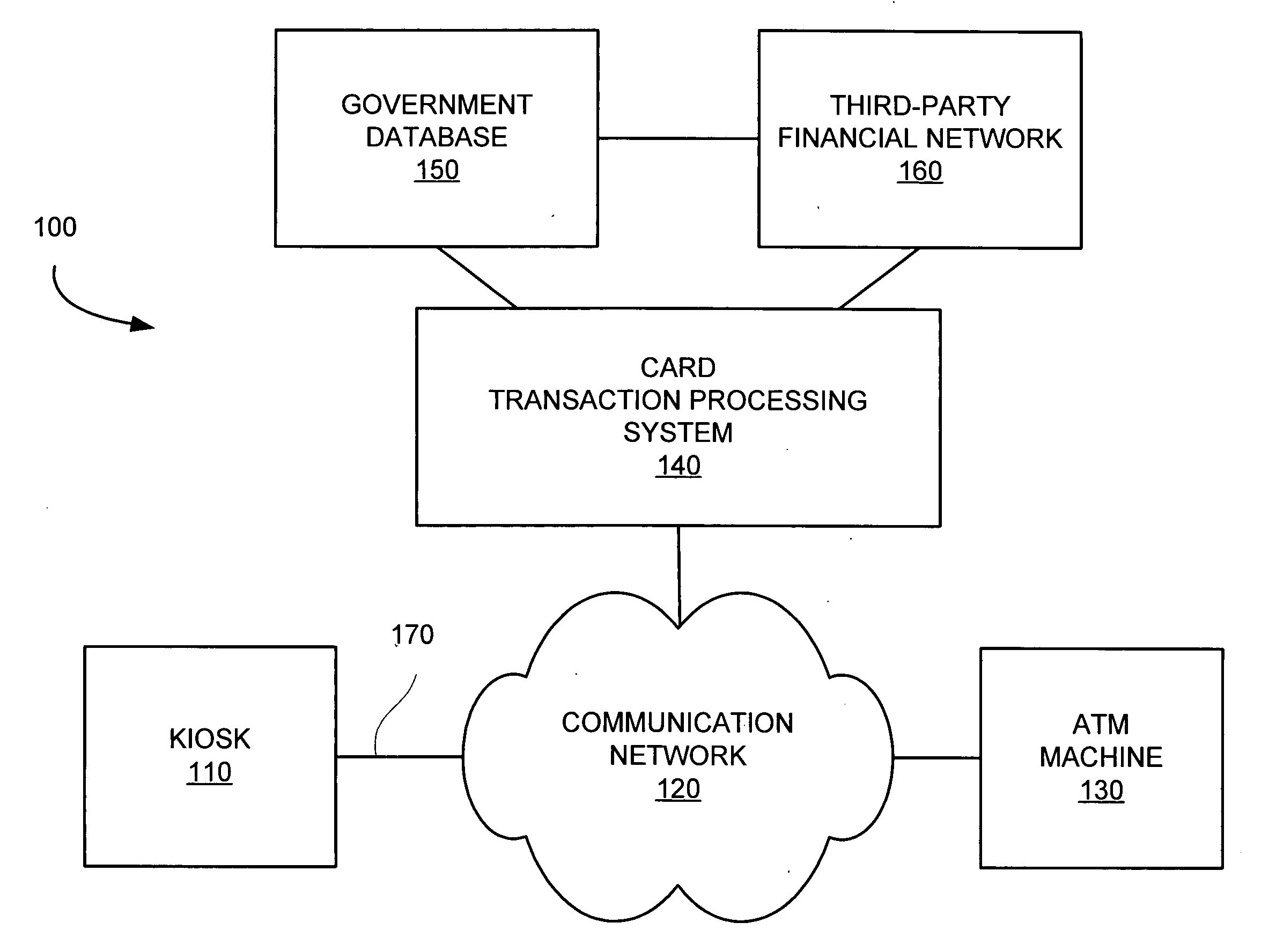

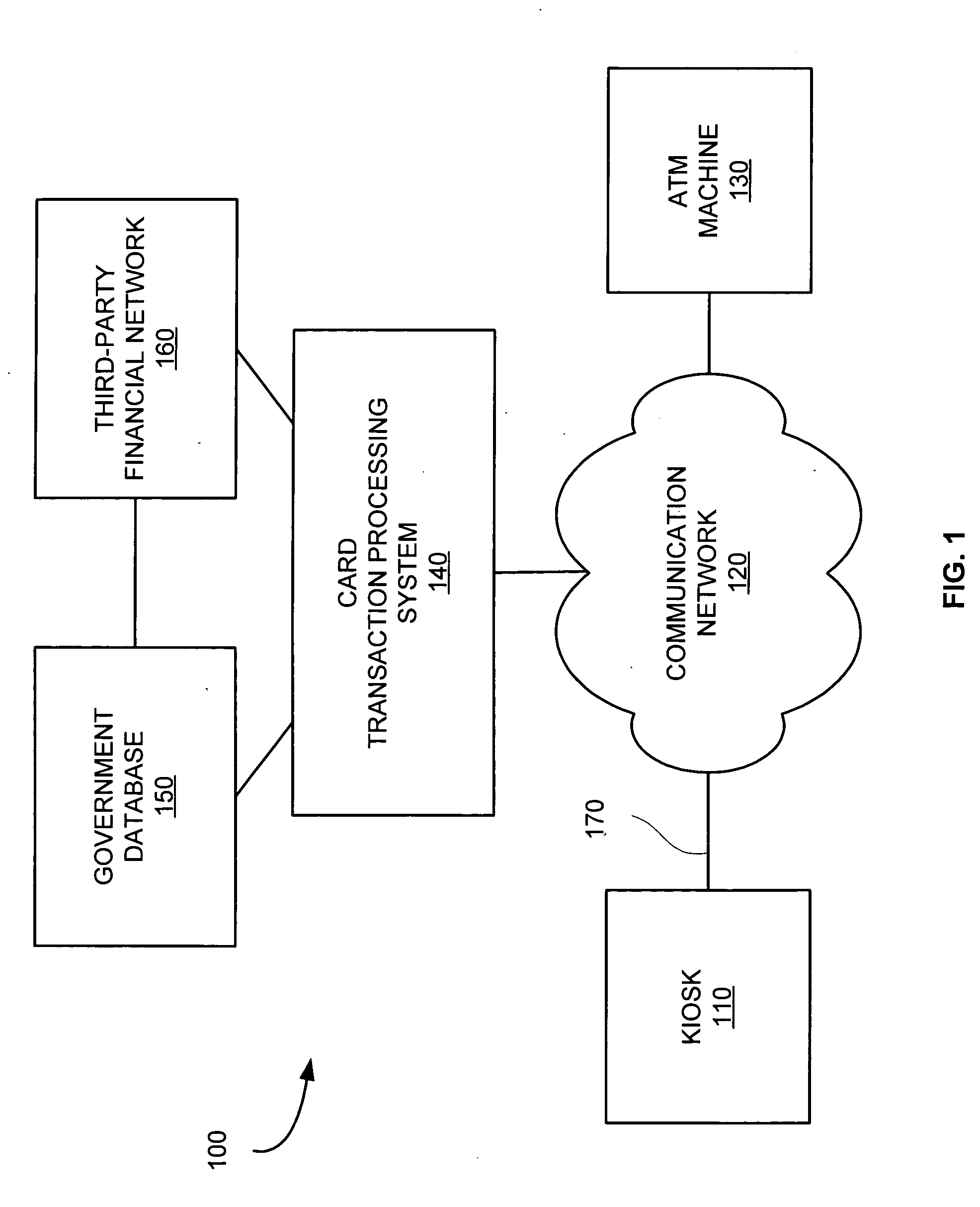

System for vending products and services using an identification card and associated methods

InactiveUS6854642B2Improve system performanceEasy to analyzeSpecial data processing applicationsVerifying markings correctnessComputer terminalDriver's license

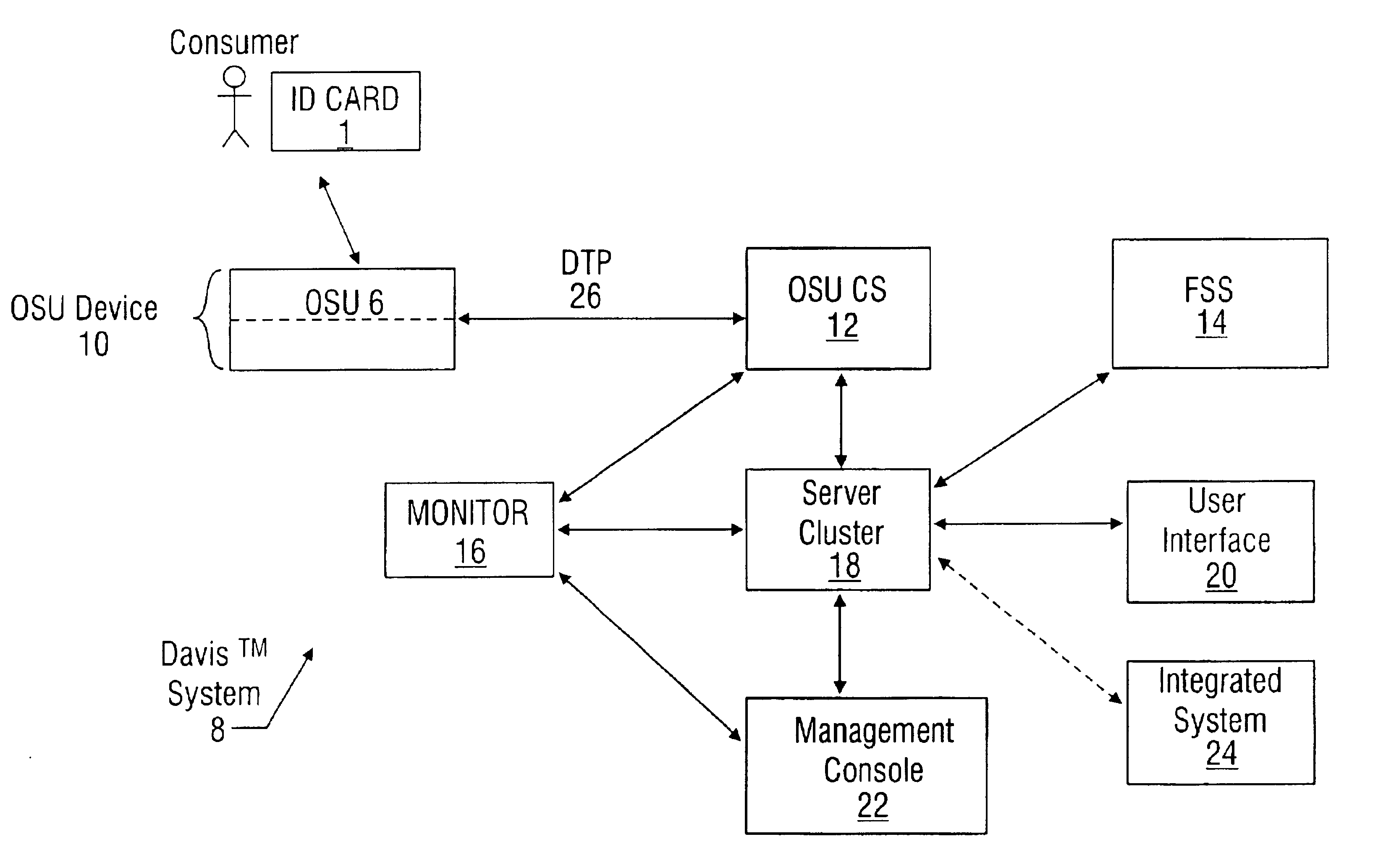

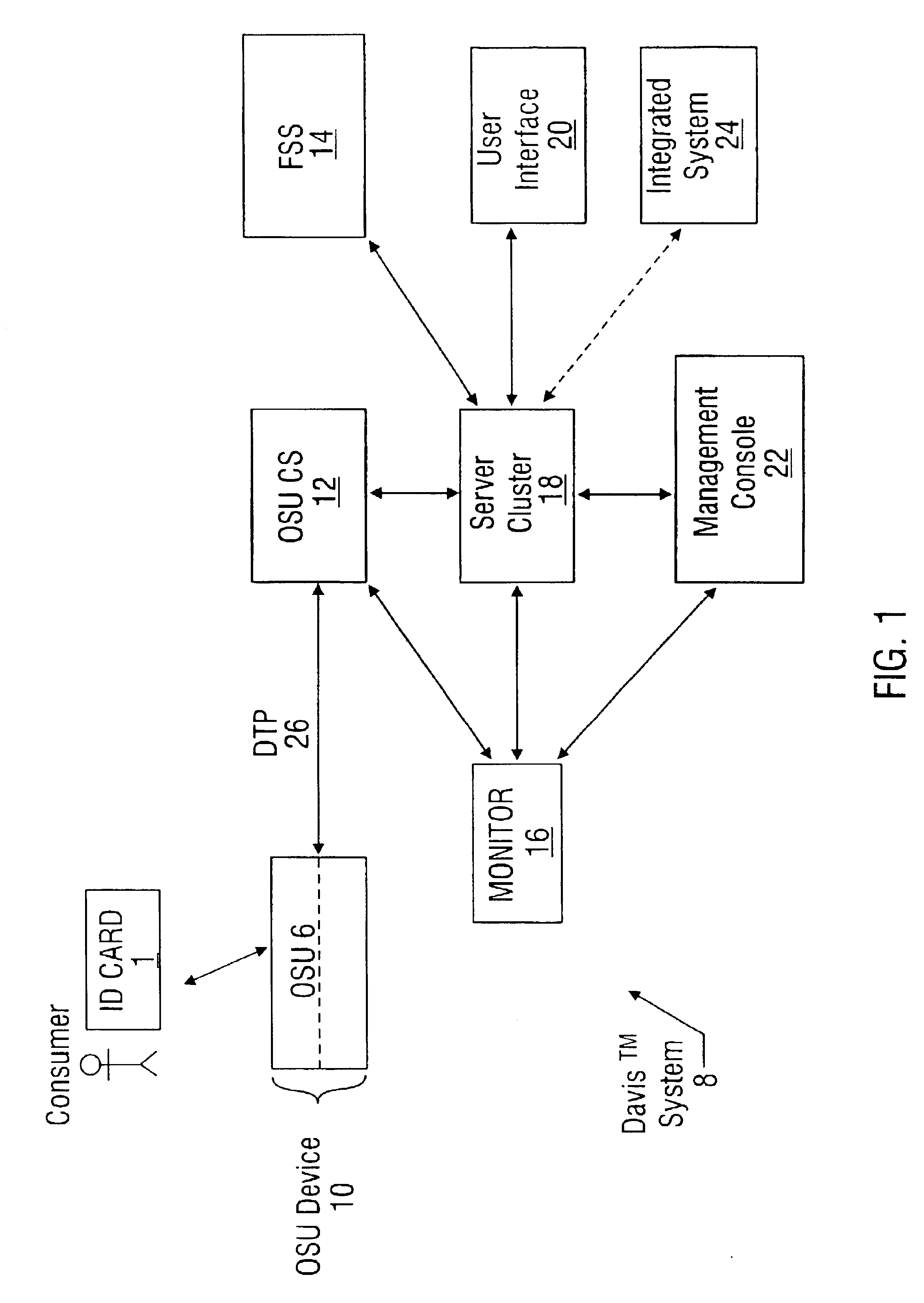

A highly integrated and flexible system for vending products and services to consumers. The system receives information in advance of the vend by having the consumer insert an identification (ID) card, preferably a driver's license, into a point-of-purchase terminal (referred to as an OSU device). The OSU device preferably contains an Optical Scanning Unit (OSU), capable of scanning the textual information on the ID card. In one embodiment, the scanned information is compared against optical templates present in the system to discern or verify the information on the ID card, and is then used by the system to enable or disable the vending transaction, and / or to allow access to several preregistered system accounts.

Owner:CNT TECH

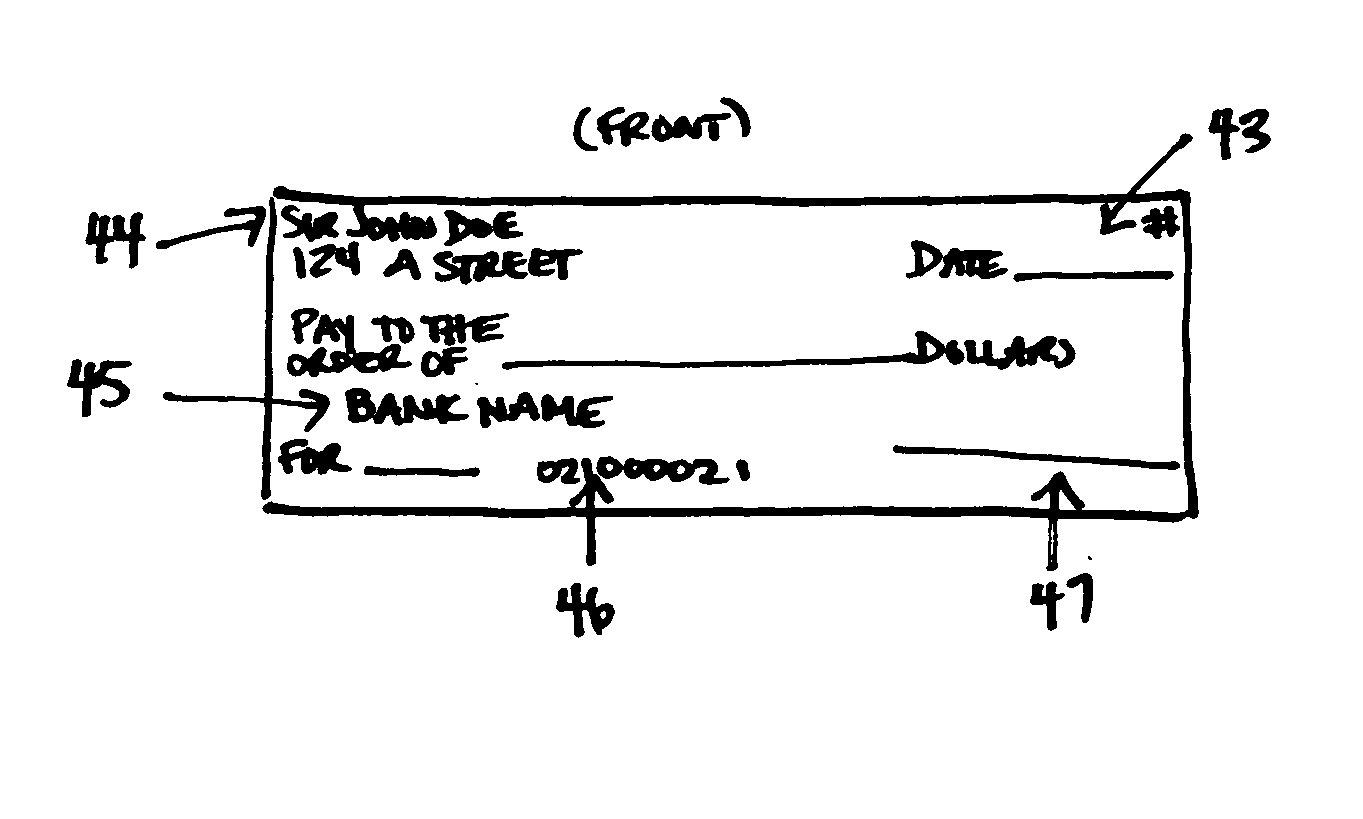

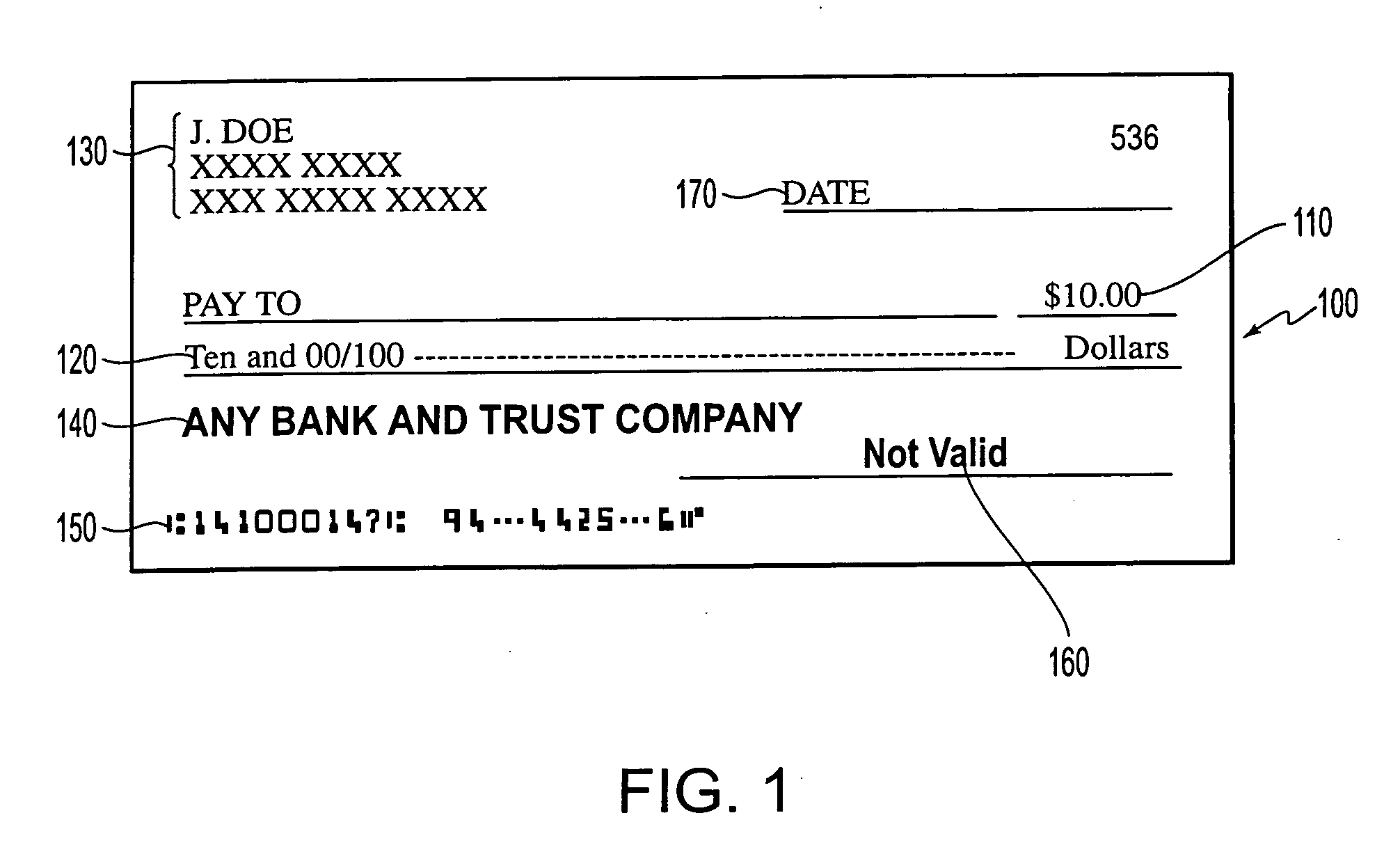

Method and system of evaluating checks deposited into a cash dispensing automated banking machine

InactiveUS7377425B1Improve reliabilityReduce riskComplete banking machinesFinanceTransaction dataCheque

An automated banking machine system and method includes ATMs which accept checks and dispense cash to users. The ATMs are operated to acquire image and magnetic data from deposited checks to determine the genuineness of checks and the authority of a user to receive cash for such checks. Cash may be dispensed to the user from the ATM in exchange for the deposited check. The ATMs dispense cash responsive to communications with a transaction host. The transaction host provides transaction identifying data to the ATM. The ATM sends the transaction identifying data and check images to an image and transaction data server for processing.

Owner:DIEBOLD SELF SERVICE SYST DIV OF DIEBOLD NIXDORF INC

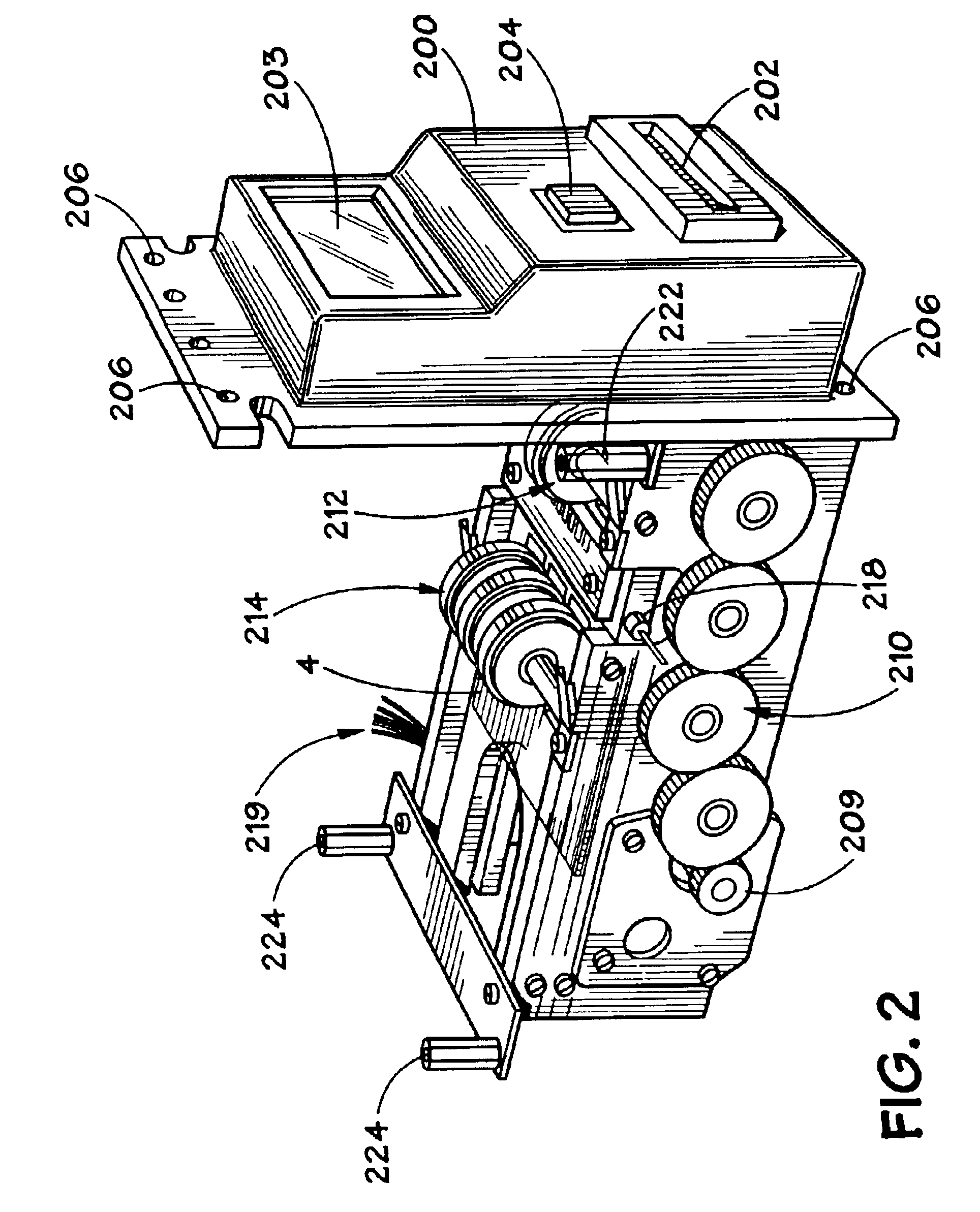

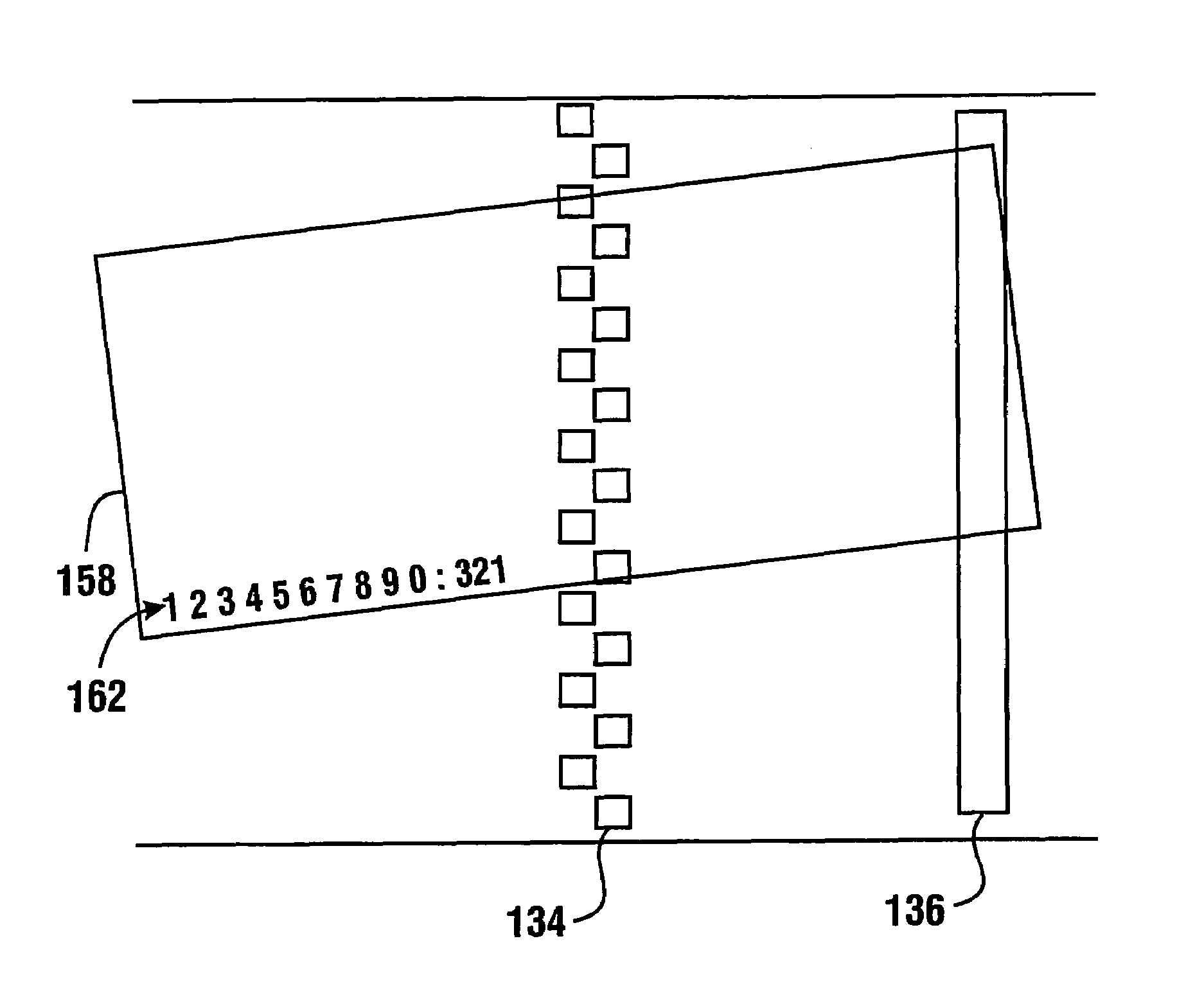

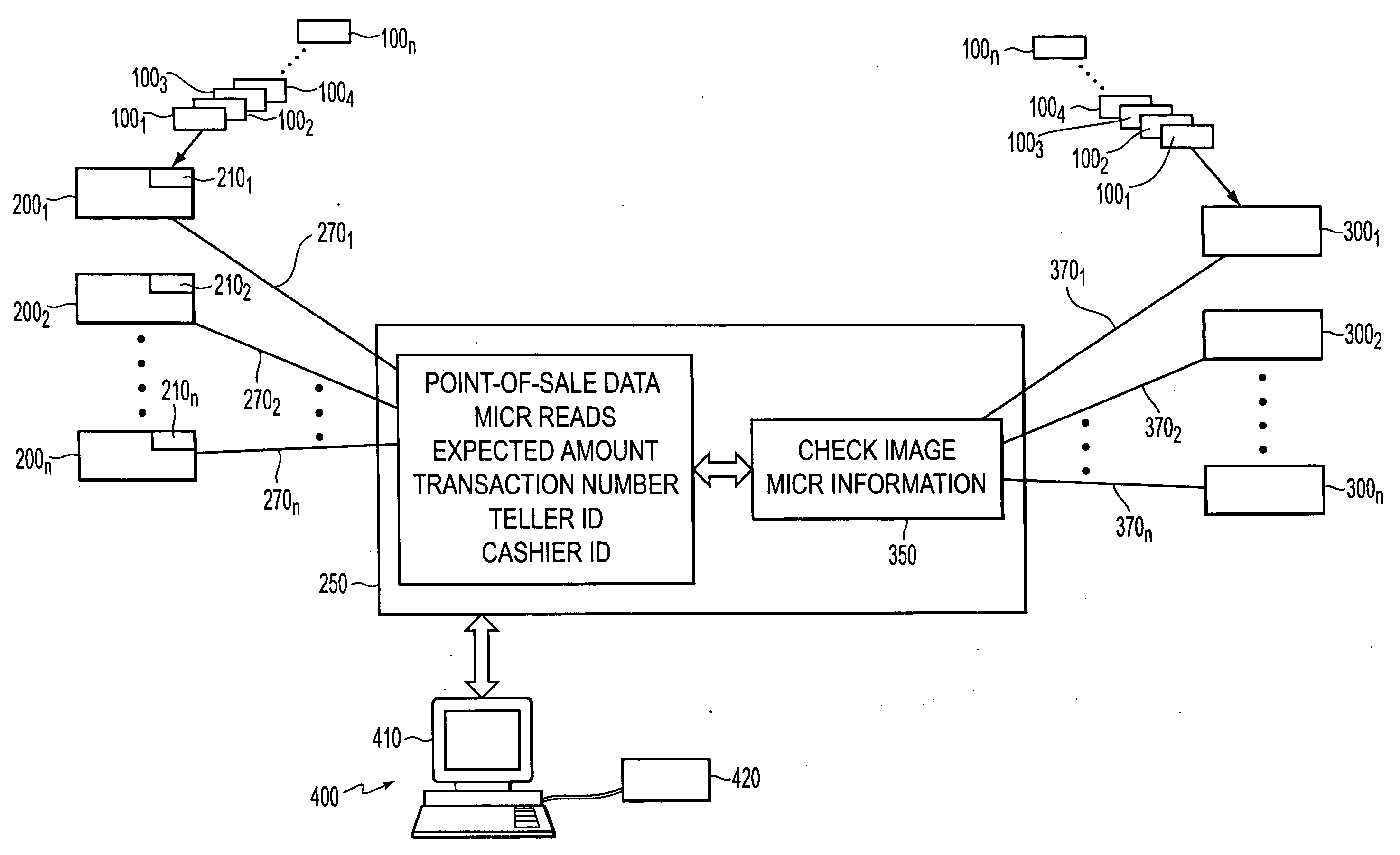

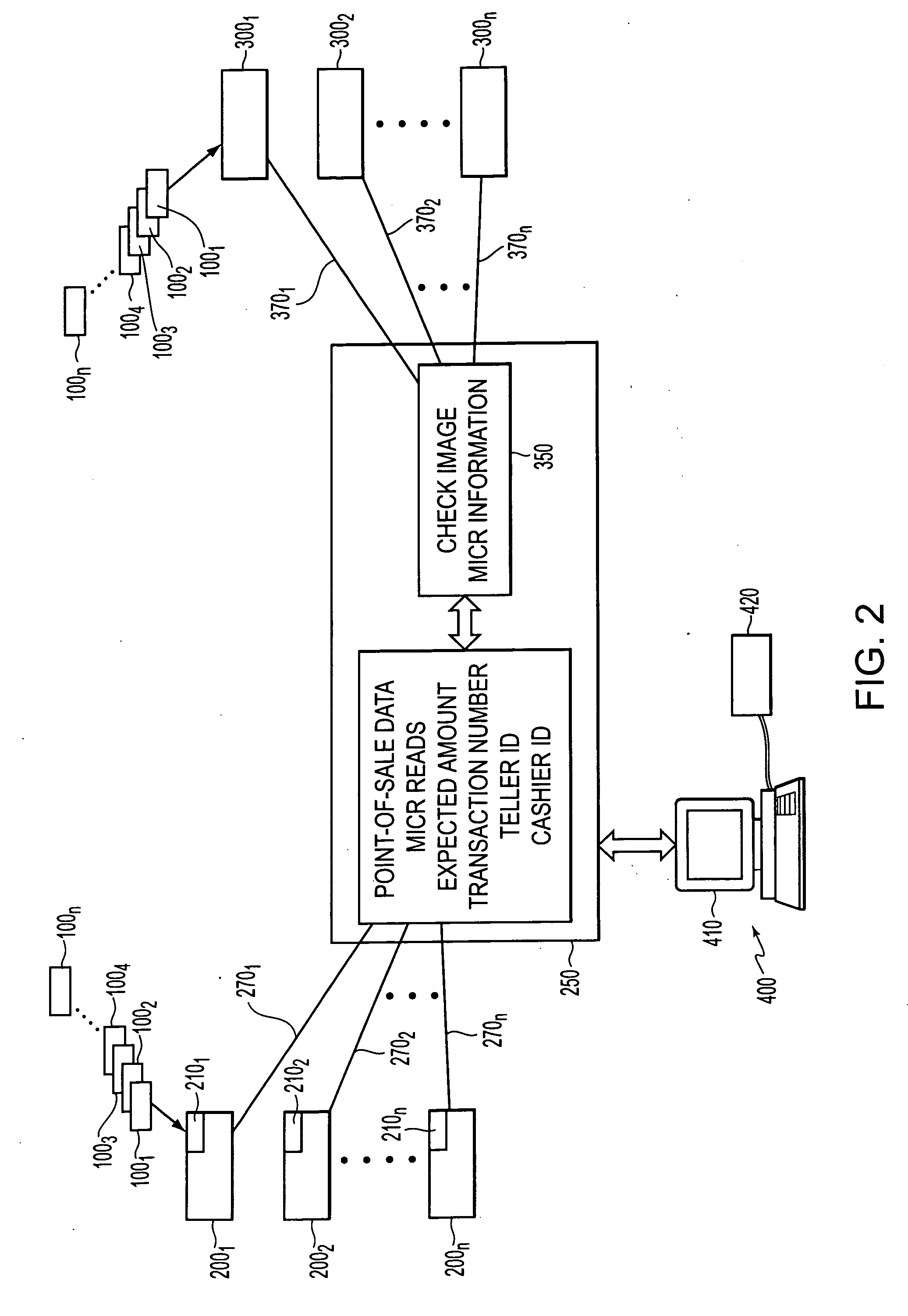

Method and apparatus for processing checks

ActiveUS20050108168A1Reduce physical activityImprove process integrityComplete banking machinesFinanceAlgorithmCheque

A check processing system and method comprising utilizes an image scanner that produces an electronic image of a check upon scanning of the check. The system and method receive the electronic image of the check from the image scanner, receive point-of-sale data generated at a point-of-sale, determine a monetary value of the check from the electronic image of the check, and reconcile the determined monetary value of the check with the point-of-sale data so that the check is correlated with a transaction that occurred at the point-of-sale.

Owner:TALARIS HLDG

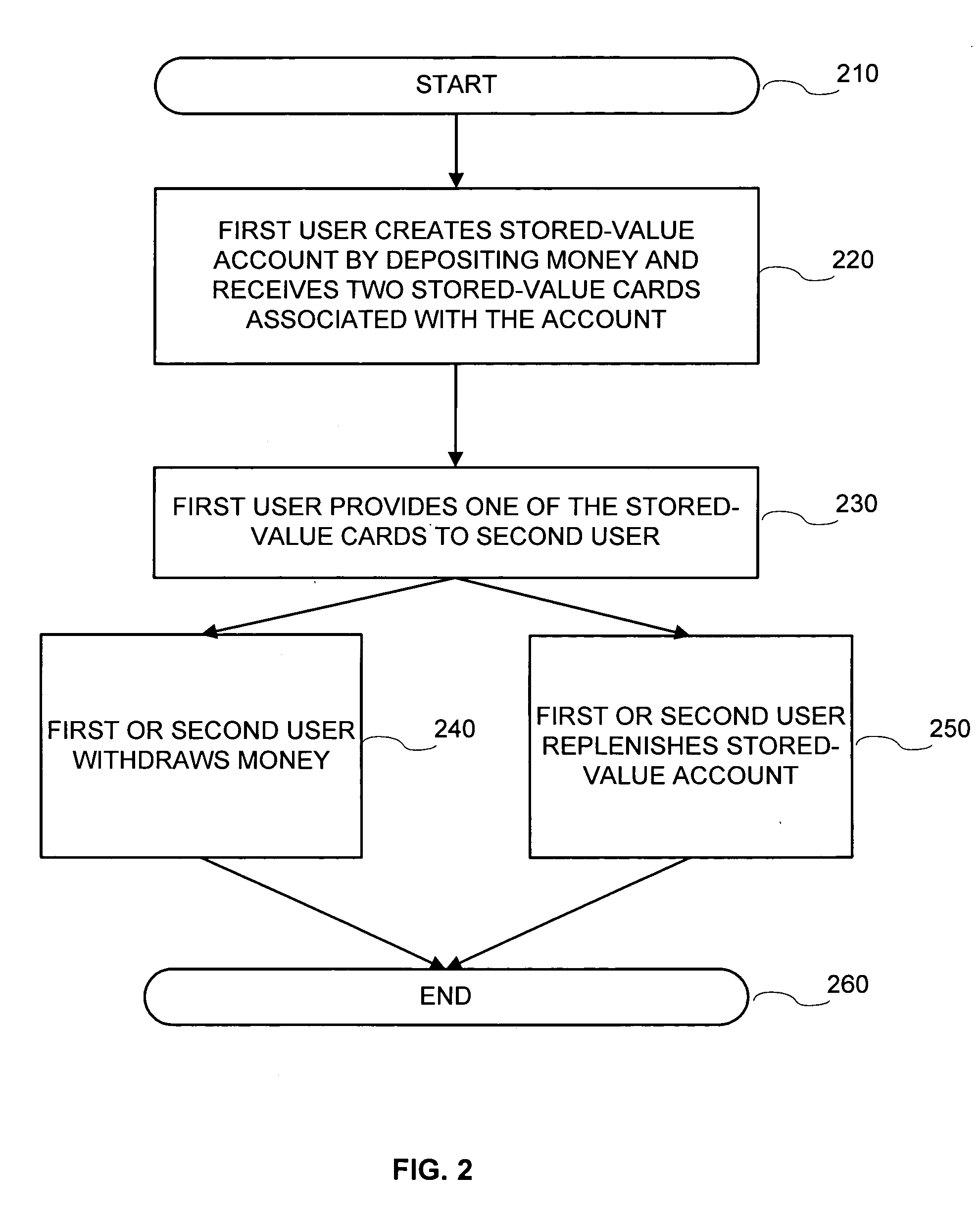

Systems and methods for money sharing

A system and a method for money sharing are provided. The system includes a processor configured to receive a deposit amount and assign an account value to a stored-value account. The stored-value account is stored in a storage device. The processor then dispenses two or more stored-value cards associated with the stored-value account. The stored-value cards can be distributed among two or more cardholders who may withdraw money from the stored-value account at a remote access unit configured to accept any of the distributed stored-value cards associated with the same account. Additional deposit amount can be received into the stored-value account from a cardholder of any distributed stored-value cards associated with the same account. The remote access unit can be unattended. The cards can be ATM-enabled.

Owner:MONEYGRAM PAYMENT SYST

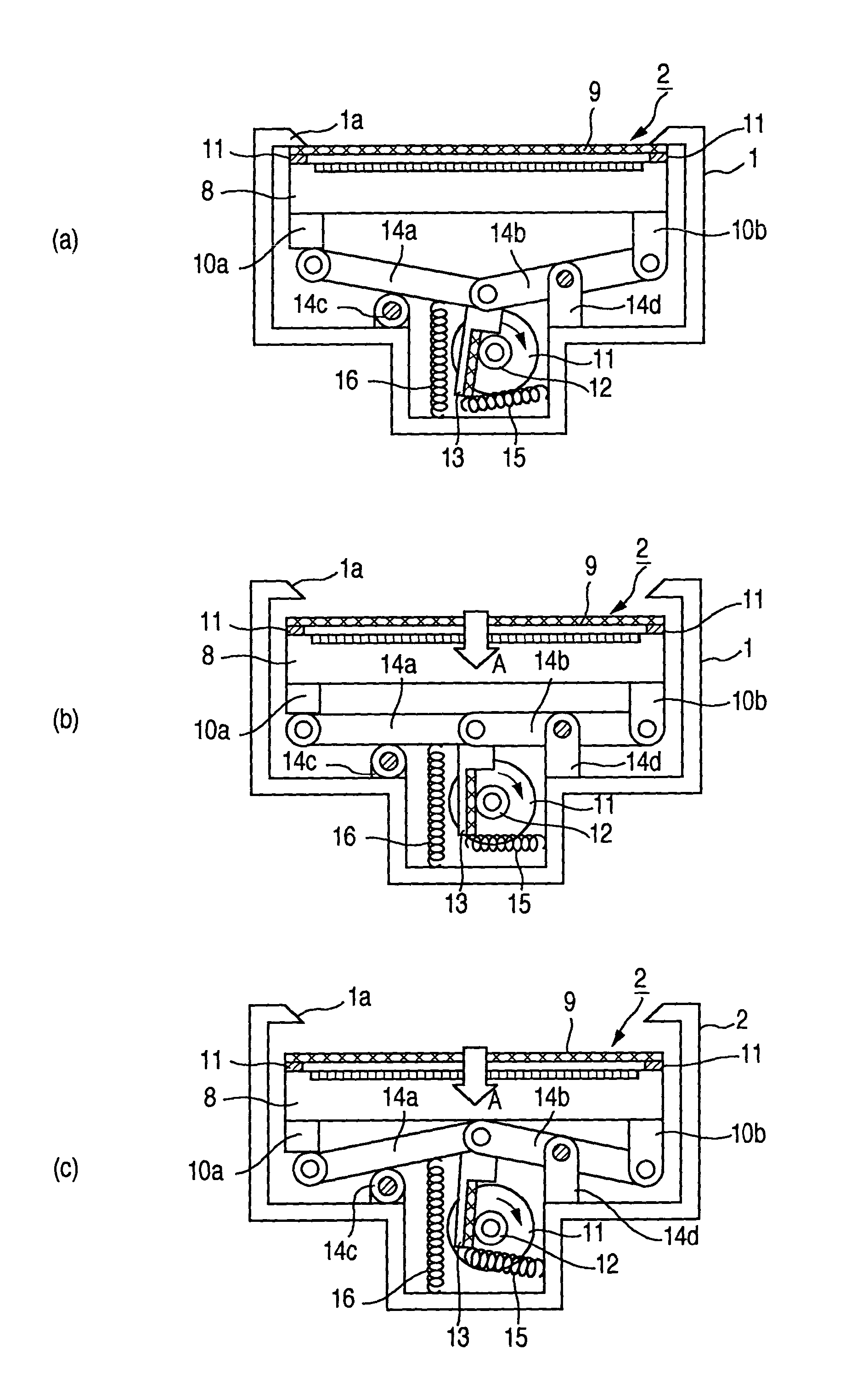

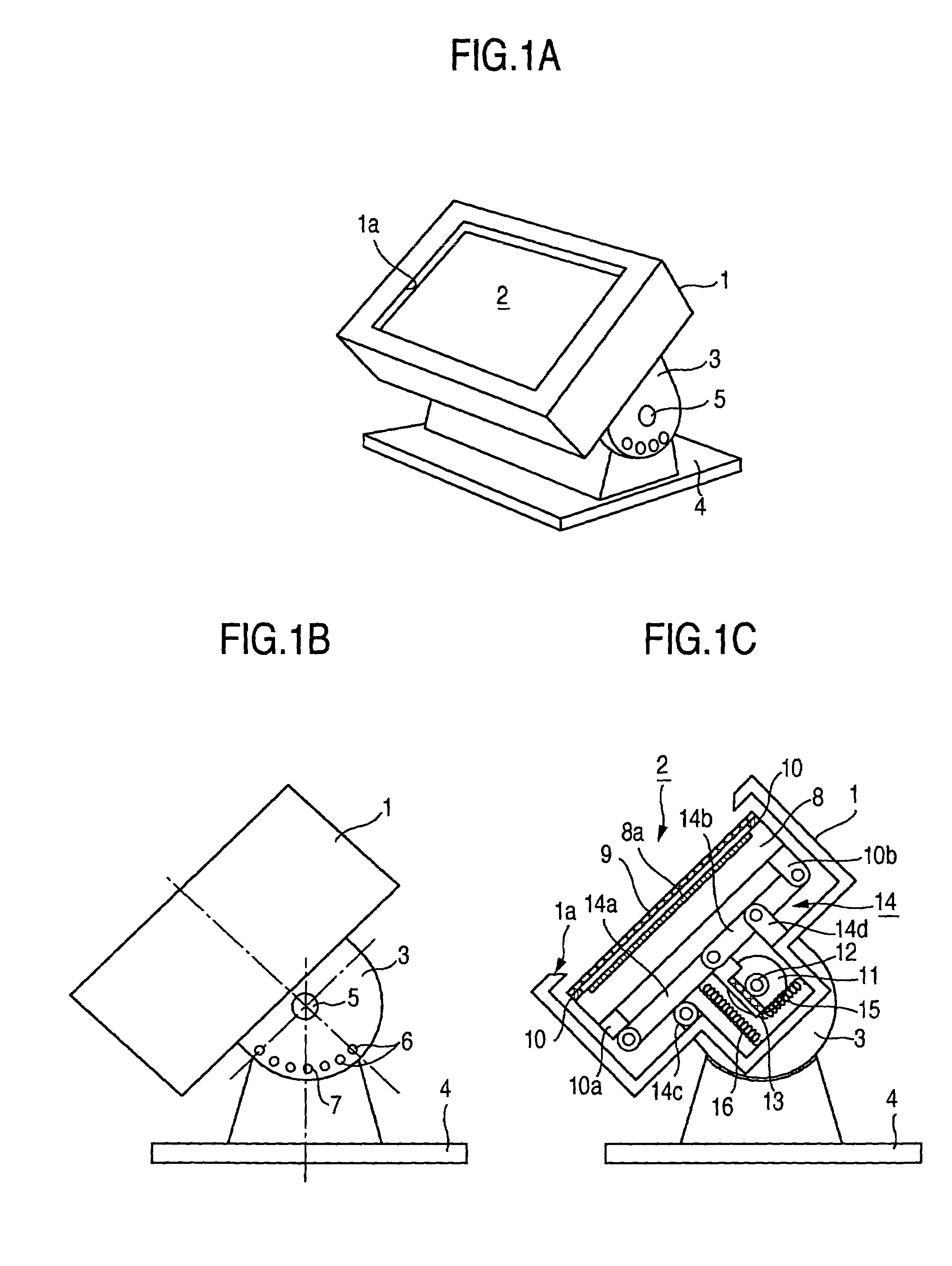

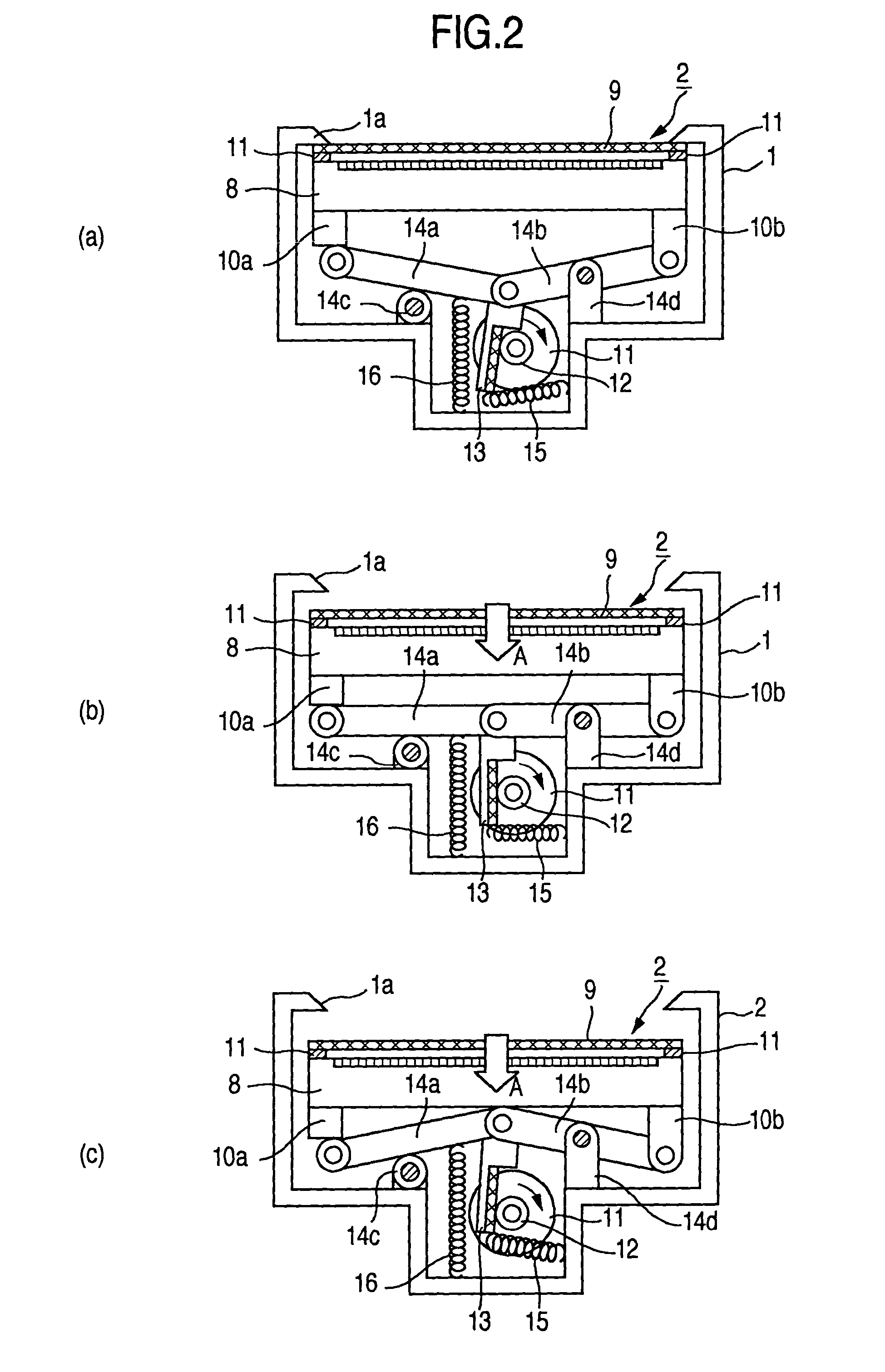

Display unit with touch panel

ActiveUS7312791B2Easy to identifyComplete banking machinesInput/output for user-computer interactionPressure senseTouchscreen

There is provided a display unit including a touch panel disposed on a display screen of a display panel to detect a touch position of a pointing device, operation being conducted by touching a touch operation member displayed on the screen. The display unit includes a sensor for sensing a pushing pressure caused when touching the touch operation member, and a control section for conducting first processing concerning the touch operation member pushed by the pointing device when the pressure sensed by the sensing unit satisfies a first predetermined pressure condition, and conducting second processing concerning the touch operation member, when the pushing pressure has changed from the first condition to a second one. Upon the change from the first condition to the second one, a function of moving the screen in a direction of pushing pressure caused by the pointer is executed by the second processing.

Owner:MAXELL HLDG LTD

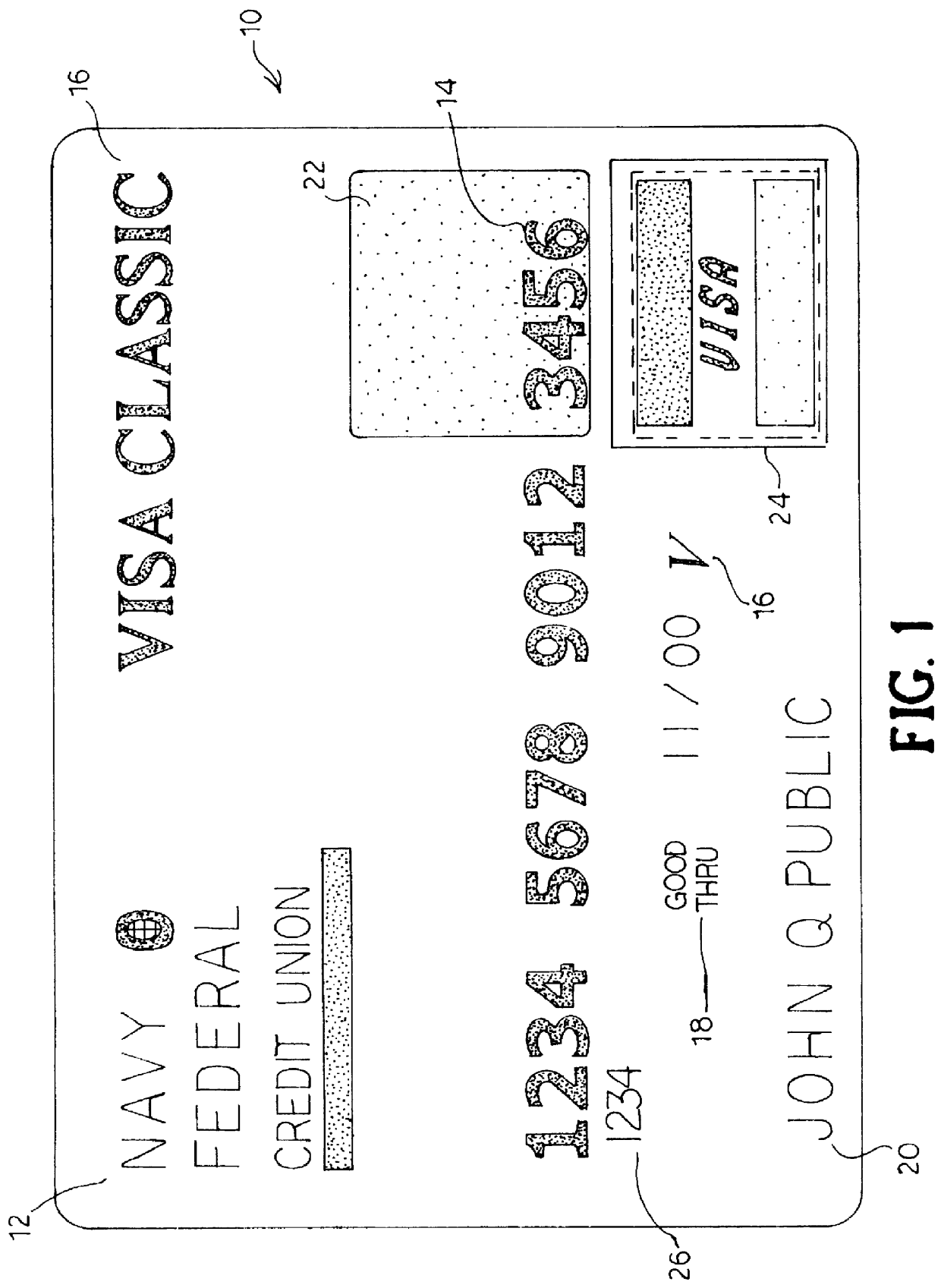

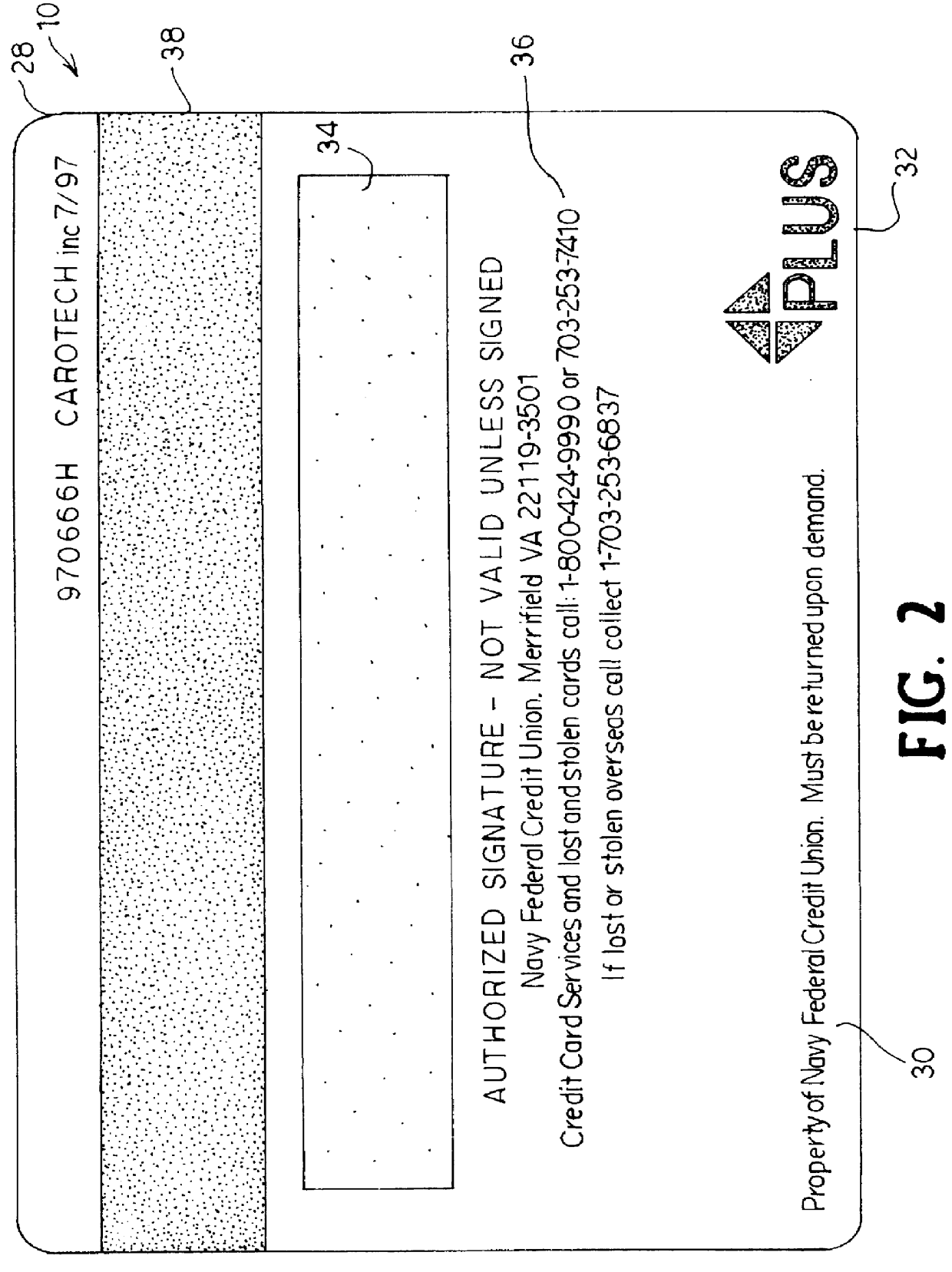

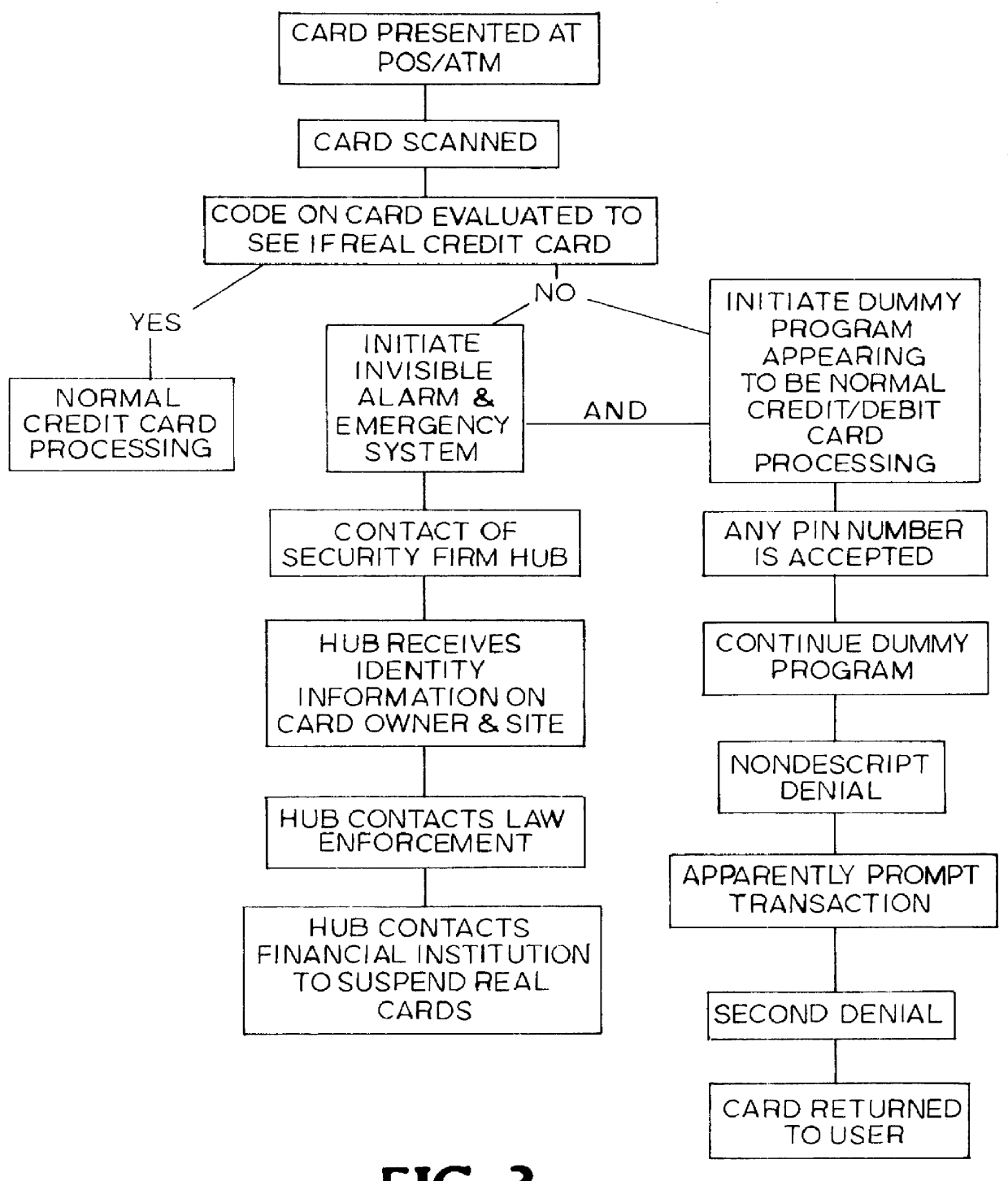

Security card and system for use thereof

InactiveUS6068184AIncreased peace of mindLower success rateComplete banking machinesFinanceCredit cardEmergency situations

A security card system that includes a security card having an appearance like a real credit card or other bank card, and a security network that contains a security firm that enrolls persons in the system who have been provided with a security card by a card-issuing institution, and uses the security network for responding to emergency calls initiated by use of the security card, reports fraud, and in general, implements an emergency system and acts as a theft deterrent.

Owner:BARNETT DONALD A

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com