Patents

Literature

1151results about "ATM accessories" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

Automated banking machine system and method

InactiveUS20030217005A1Good user interfaceFunction increaseBuying/selling/leasing transactionsSpecific program execution arrangementsEmail addressCheque

A system and method of providing an electronic transaction receipt from a cash dispensing ATM. A bank host computer is operable to submit the receipt to a system address of record with the bank. The address of record corresponds to an e-mail address, phone number or other address associated with an account involved in the transaction. The receipt may include an image or images associated with the transaction. Thus, a user of an ATM is able to receive an electronic receipt corresponding to the ATM transaction. The system may also operate to image deposited checks deposited at an ATM. Copies of the imaged checks and other information can be electronically sent to a maker, payee, a clearinghouse or banks involved with the transaction. The system may also operate to provide the user with blank checks in hard copy or virtual checks for transactions.

Owner:DIEBOLD NIXDORF

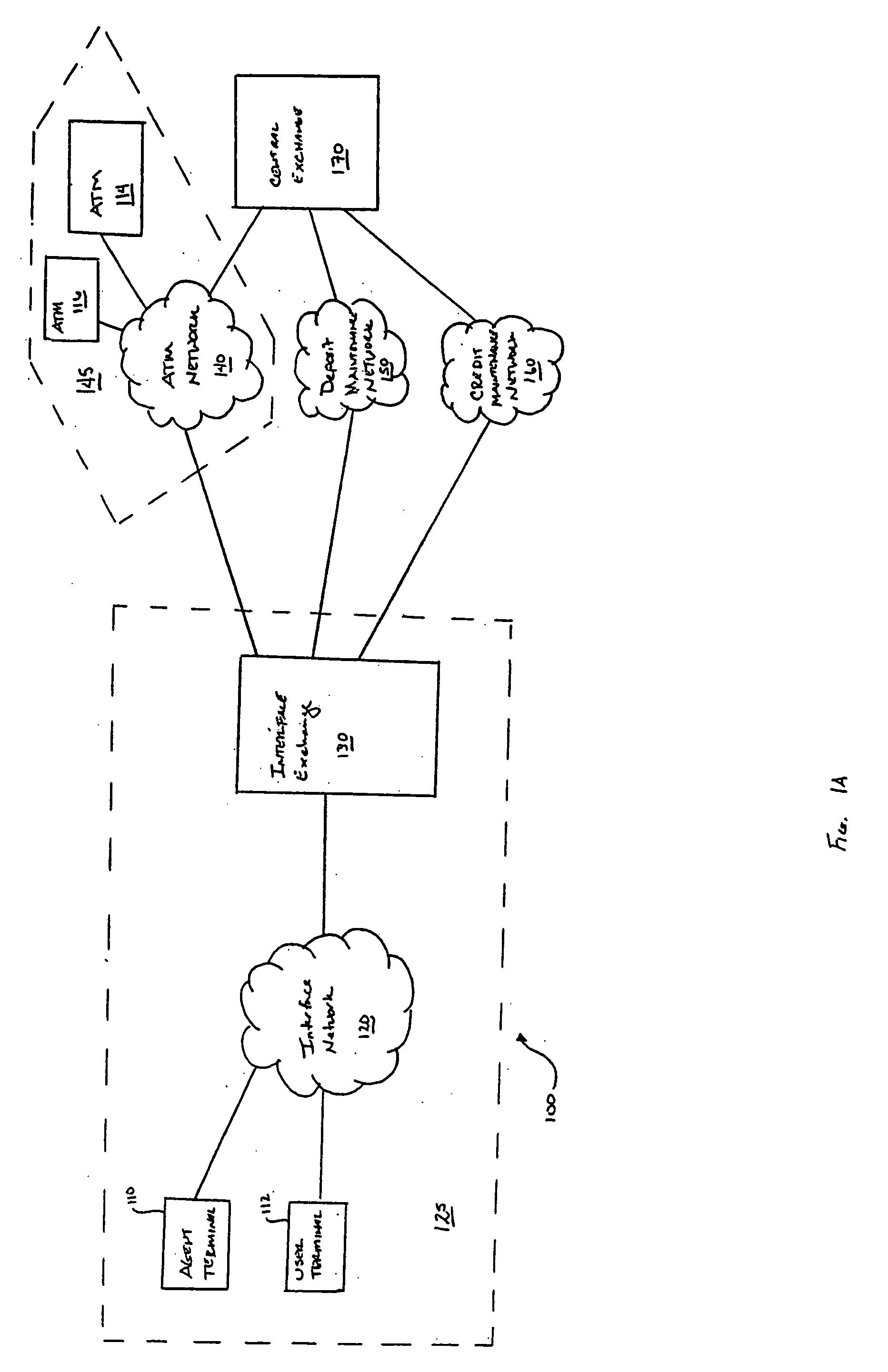

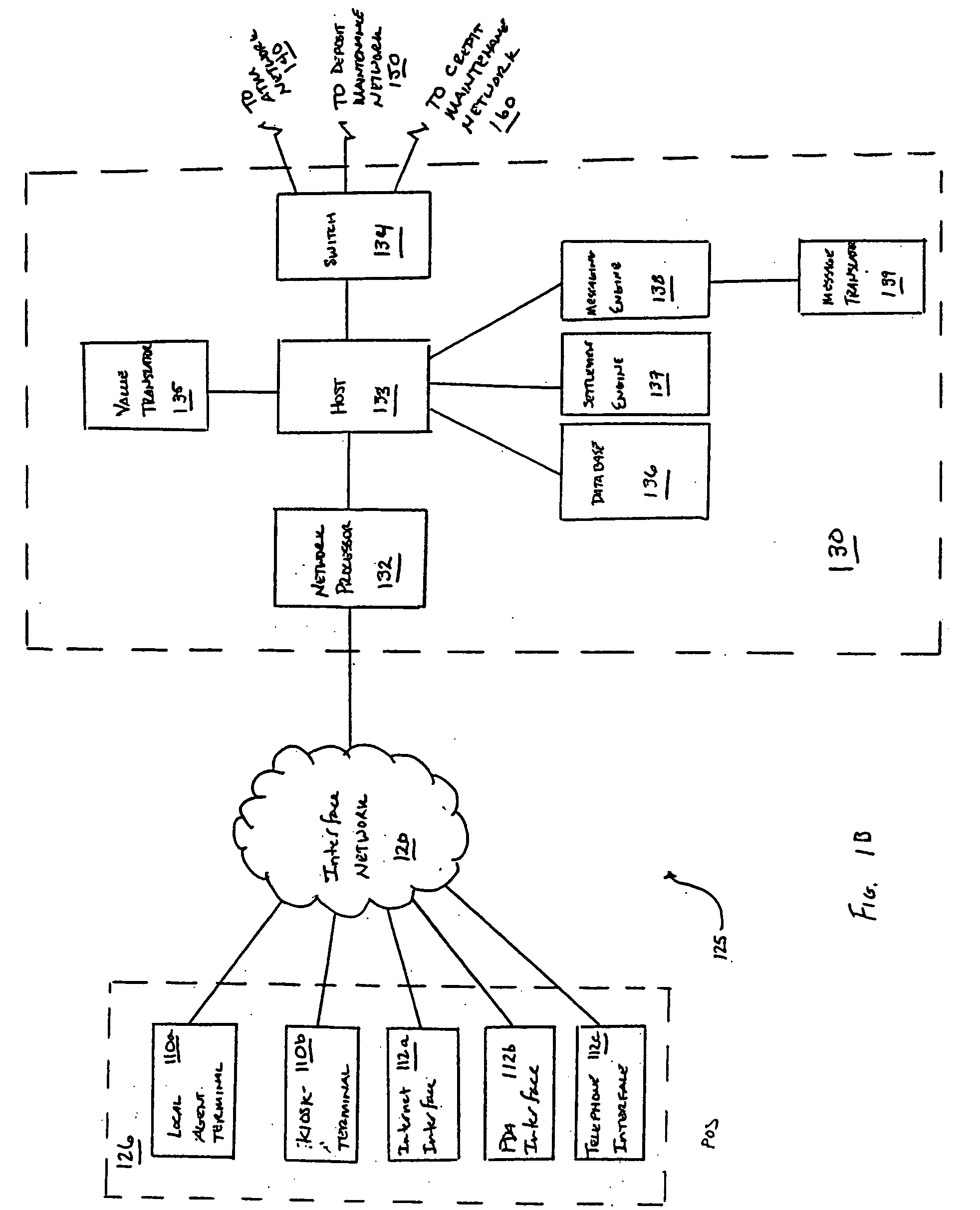

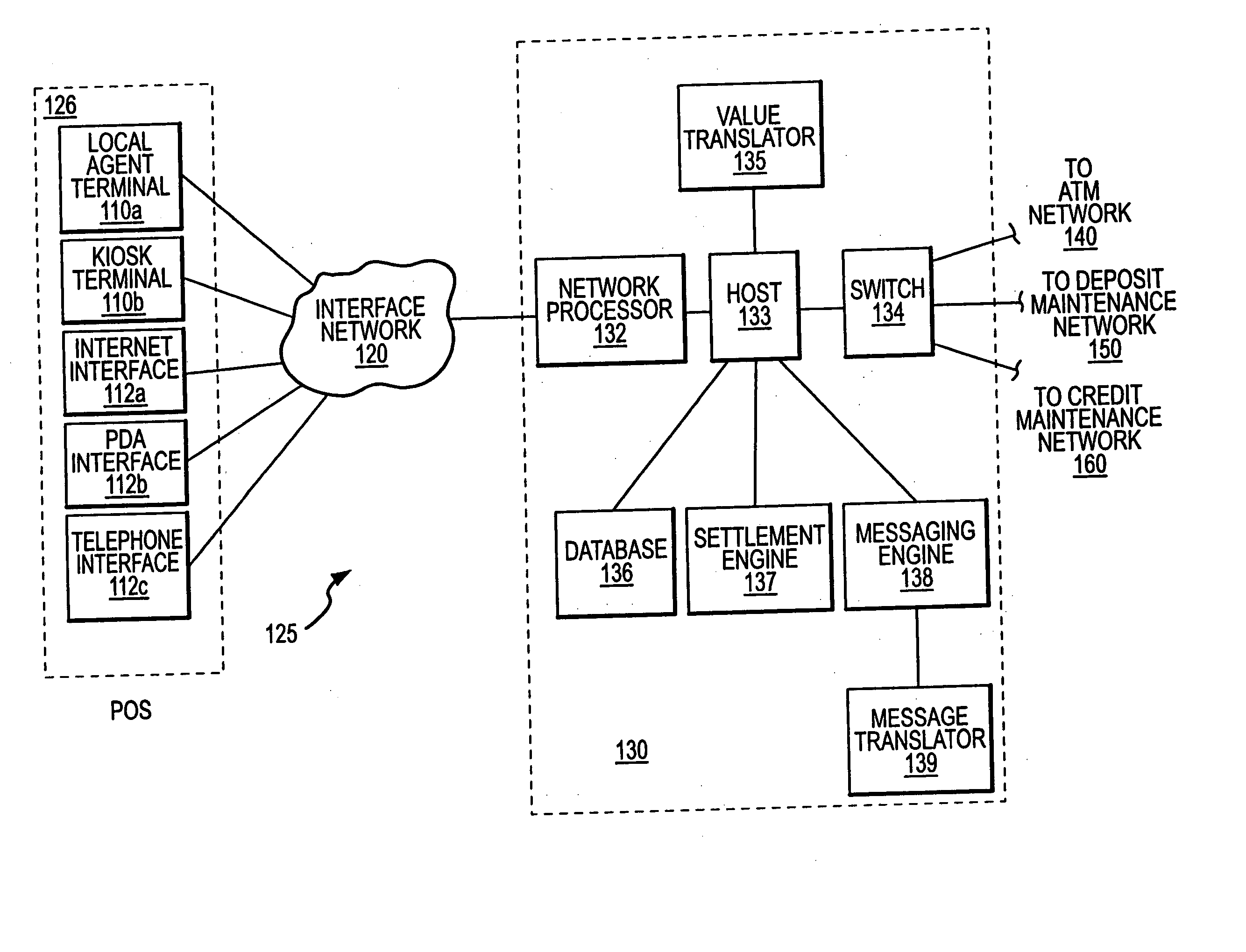

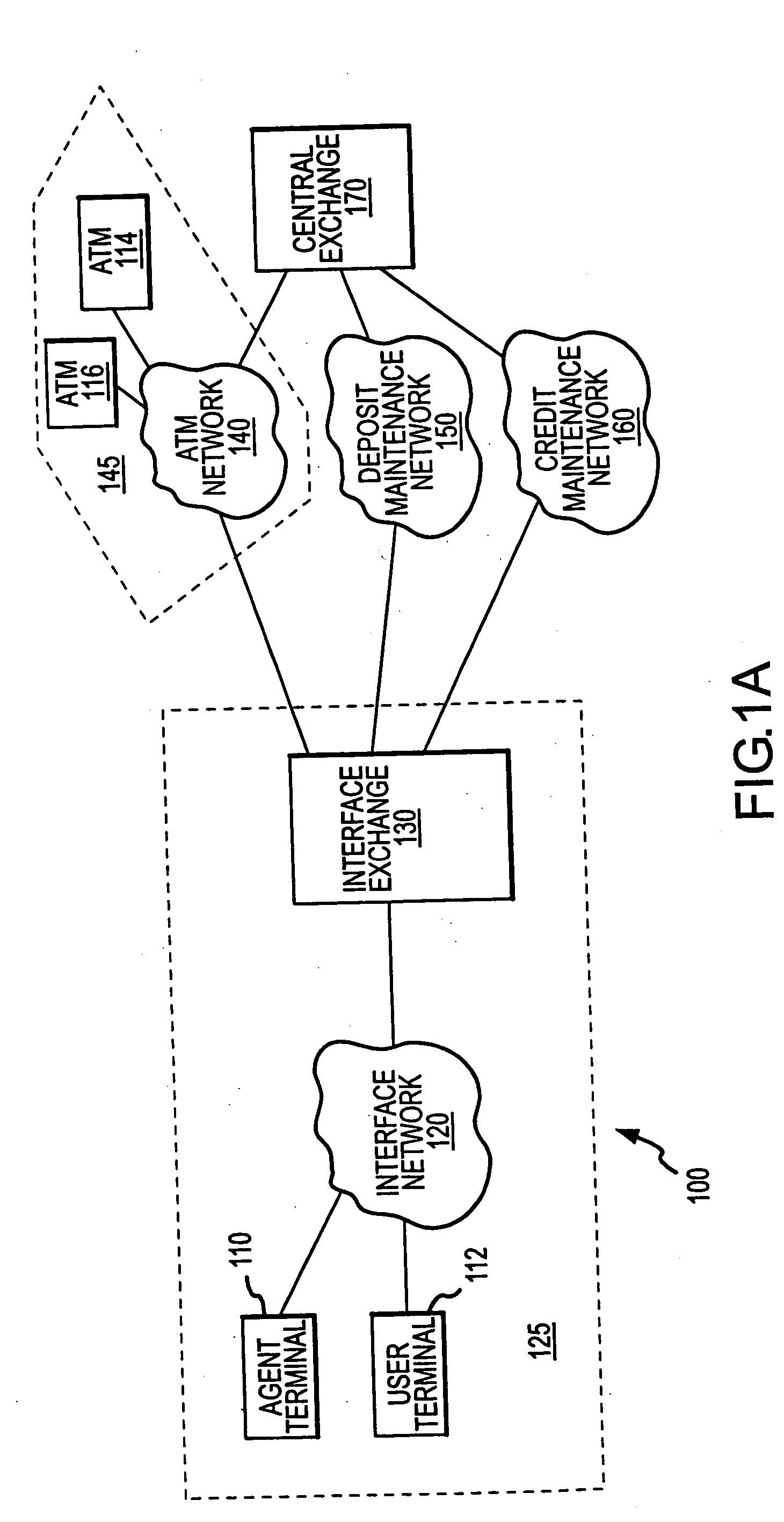

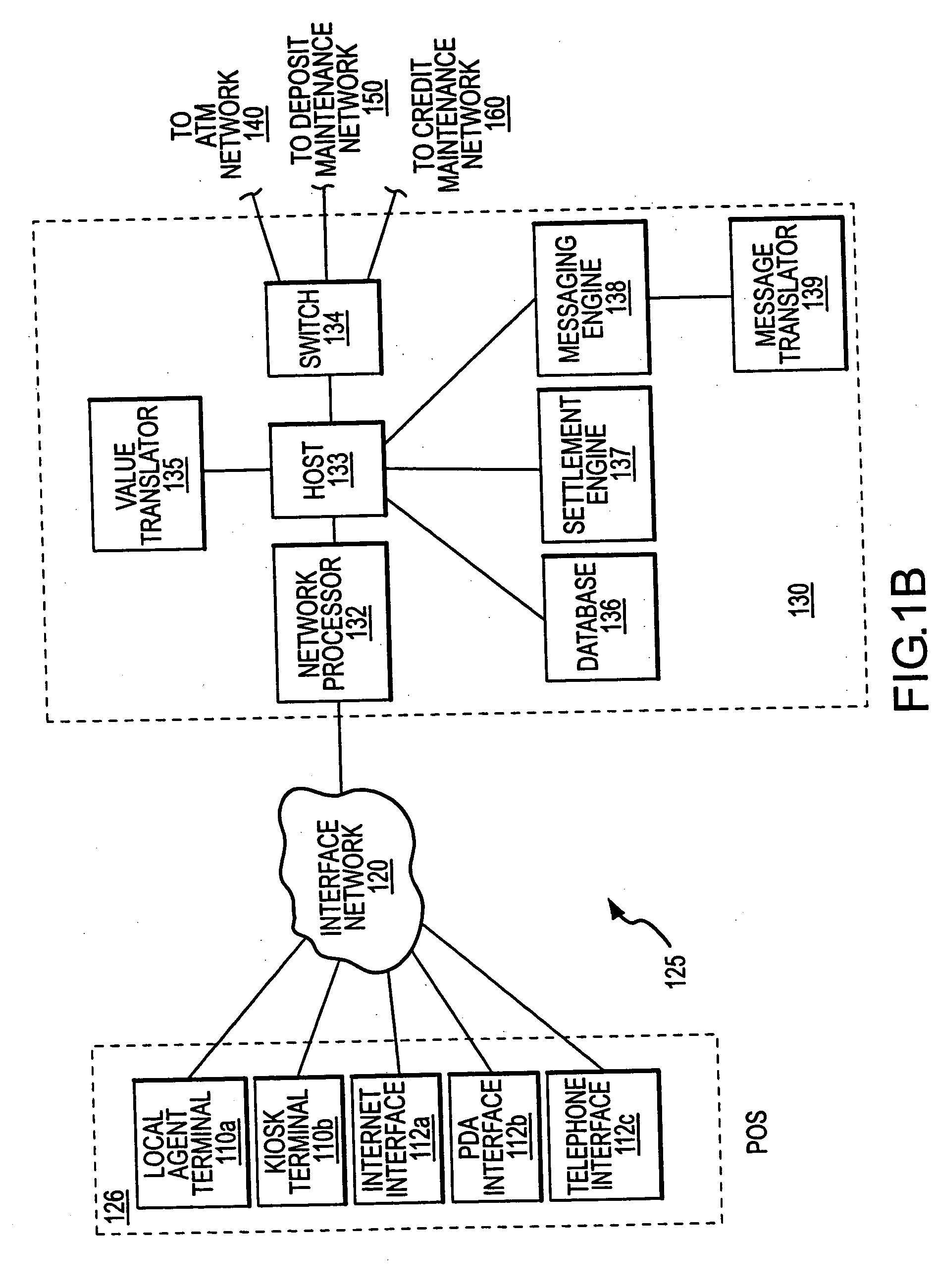

System and method for performing money transfer transaction using TCP/IP

InactiveUS6502747B1Low costShorten the timeComplete banking machinesFinanceInternet protocol suiteProtocol for Carrying Authentication for Network Access

A method of performing a money transfer transaction through a financial services institution includes receiving information regarding the transaction on a first computer of the financial services institution from a first electronic device using the Transmission Control Protocol / Internet Protocol suite (TCP / IP). The method may also include establishing a T1 connection between the first computer and the first electronic device. A system for performing a money transfer transaction using TCP / IP is also disclosed.

Owner:THE WESTERN UNION CO

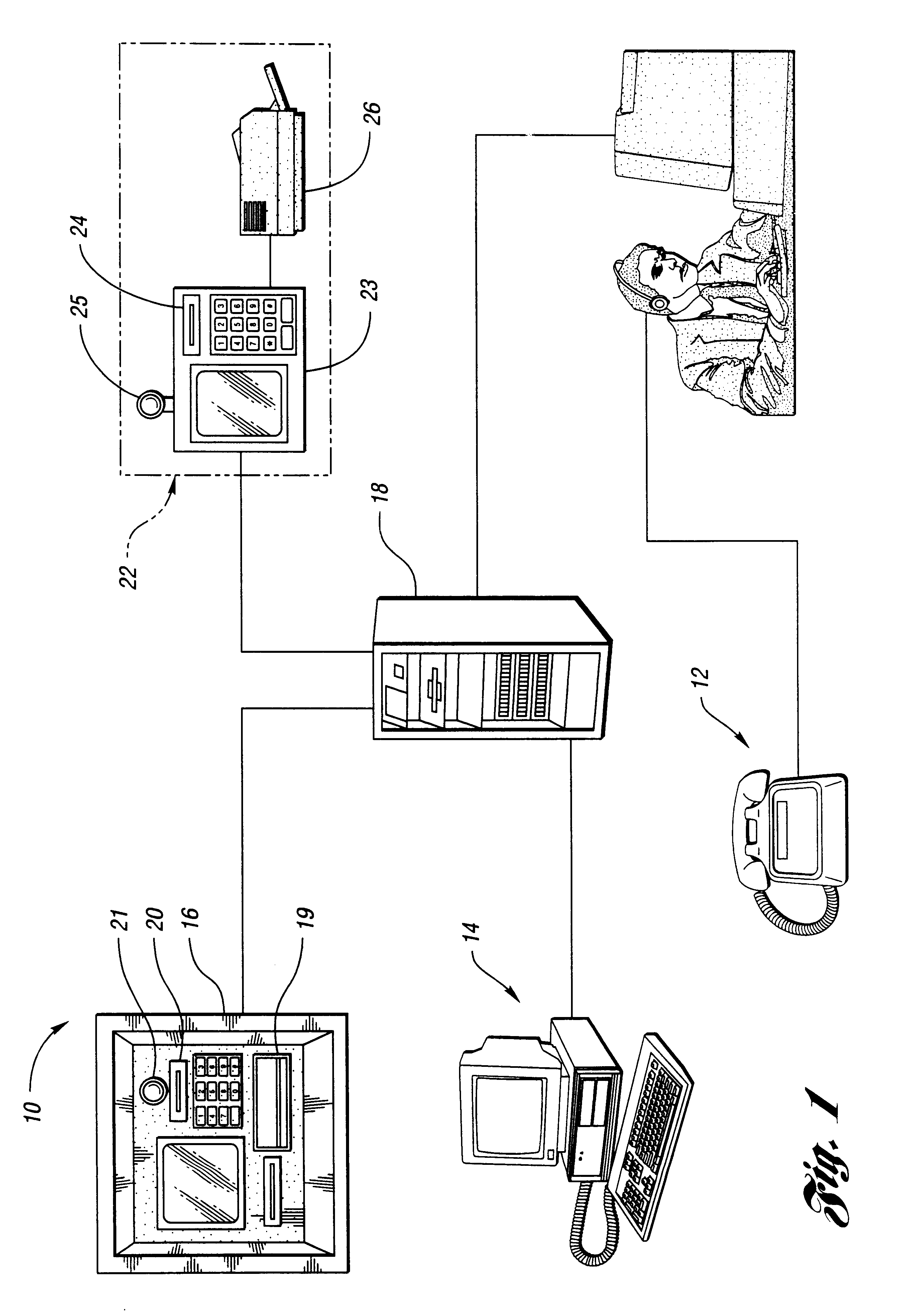

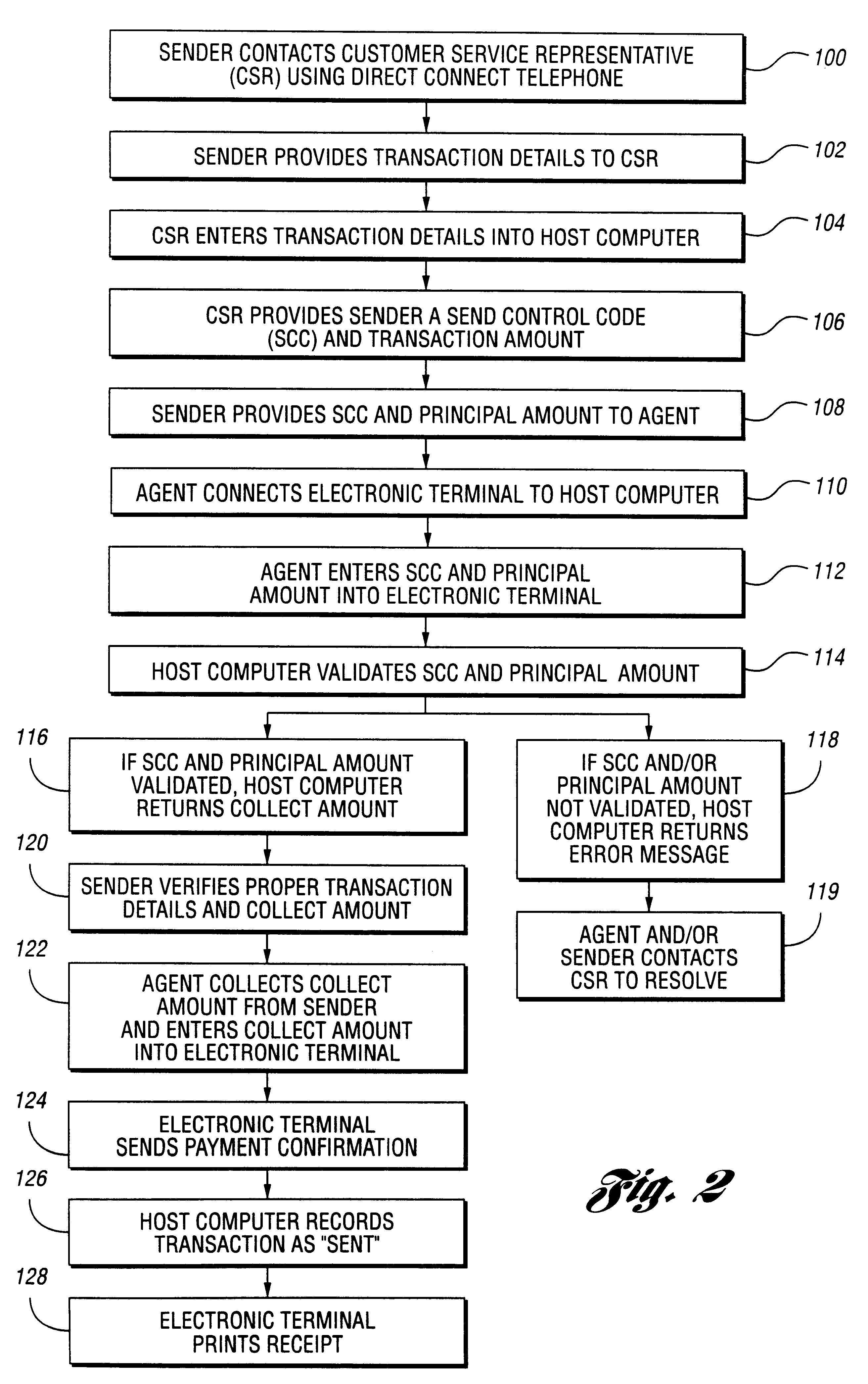

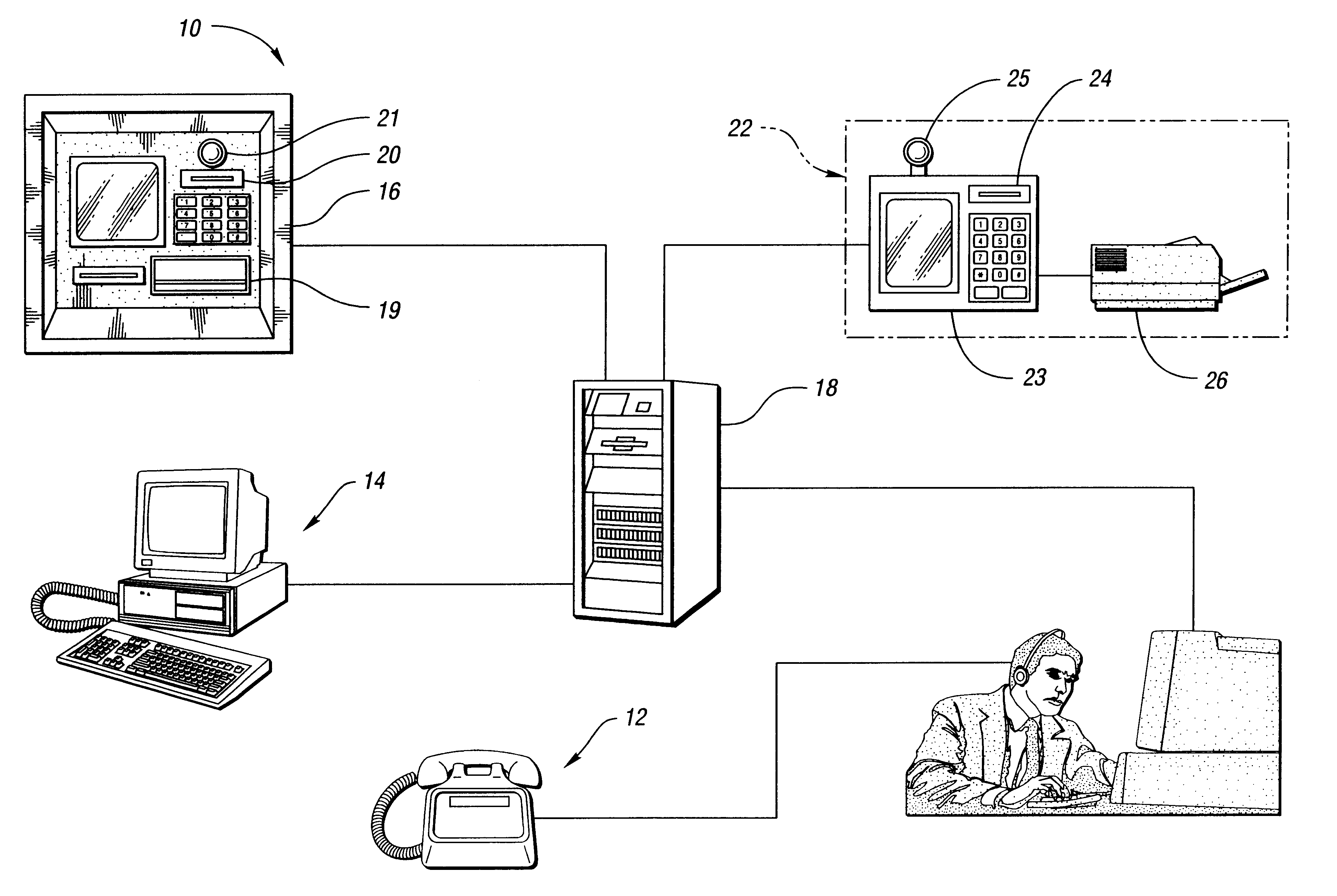

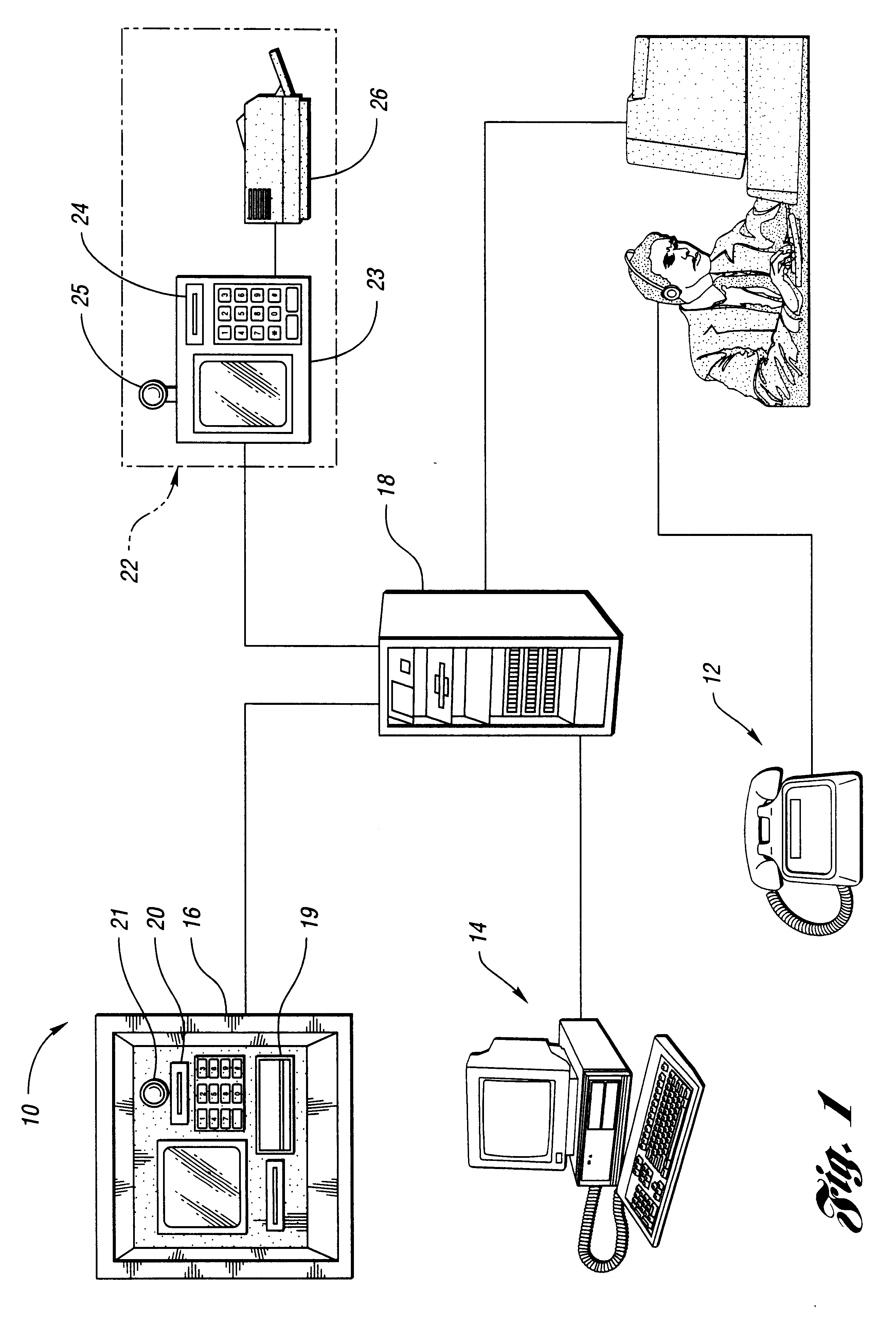

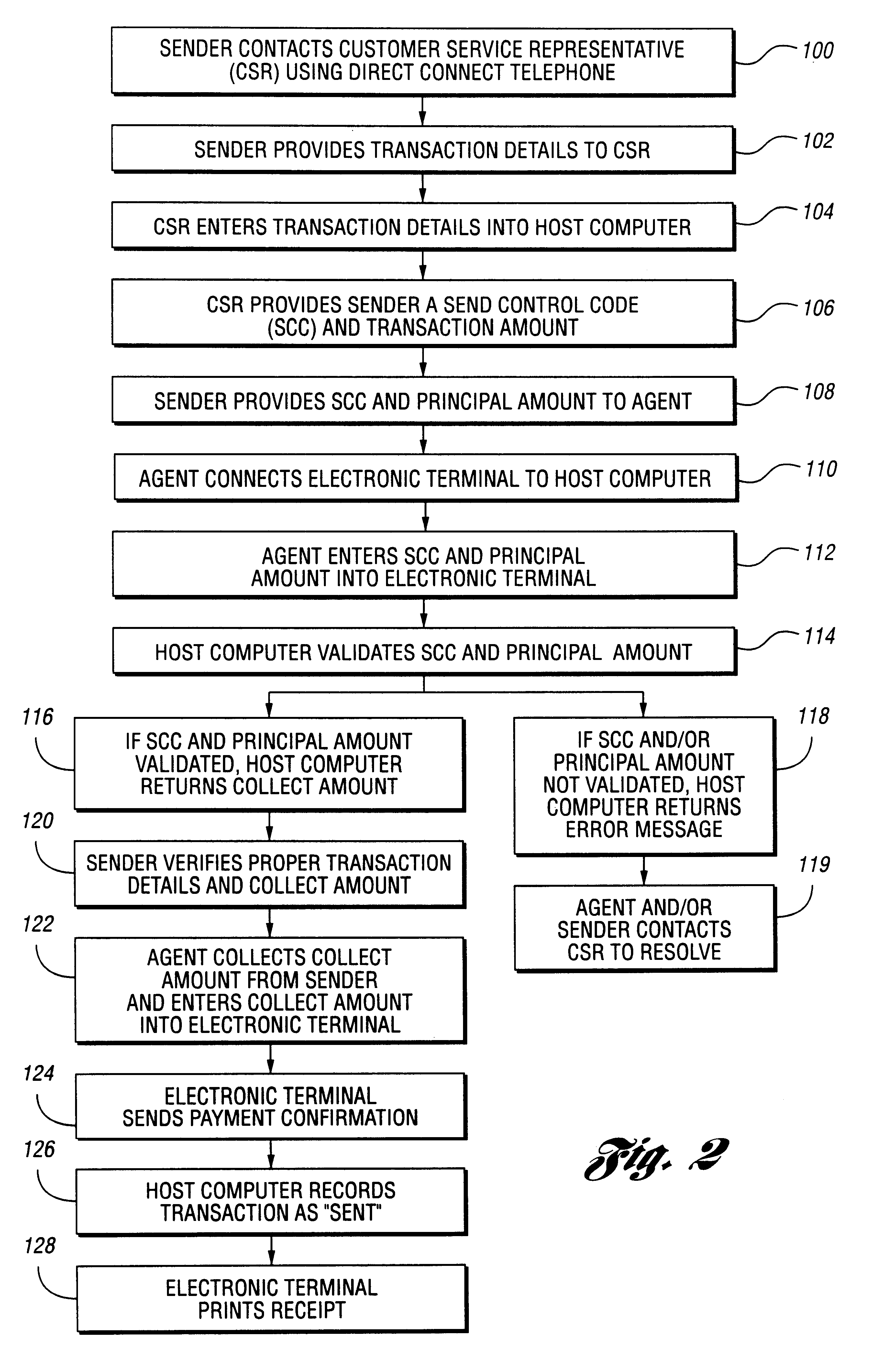

Method and system for performing money transfer transactions

InactiveUS6488203B1Shorten transaction timeImprove accuracyComplete banking machinesFinanceComputer scienceDatabase

A method of performing a send money transfer transaction through a financial services institution includes storing transaction details on a data base, wherein the transaction details include a desired amount of money to be sent; establishing a code that corresponds to the transaction details stored on the data base; entering the code into an electronic transaction fulfillment device in communication with the data base to retrieve the transaction details from the data base; and determining a collect amount based on the transaction details. A system for performing a send money transfer transaction is also disclosed.

Owner:THE WESTERN UNION CO

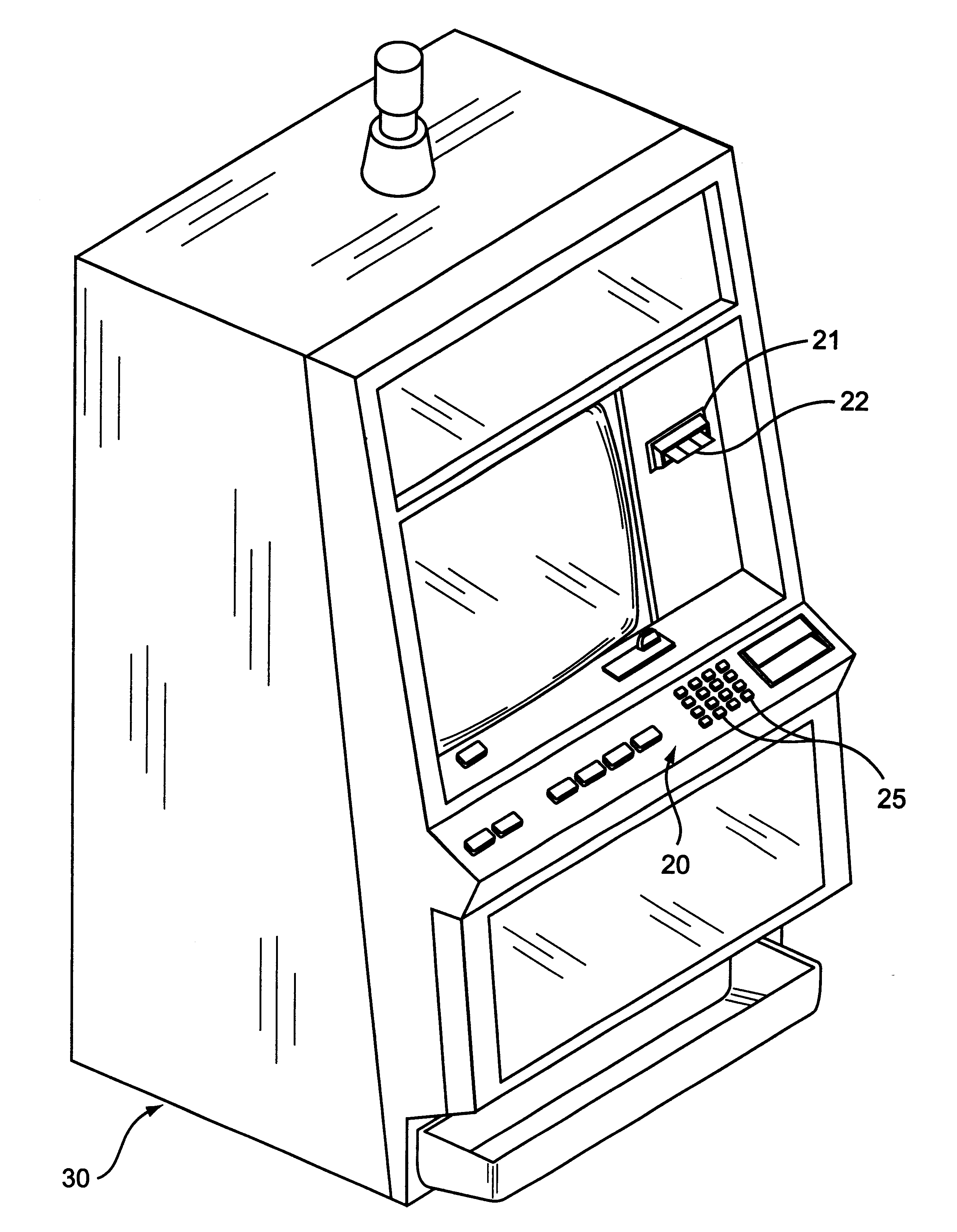

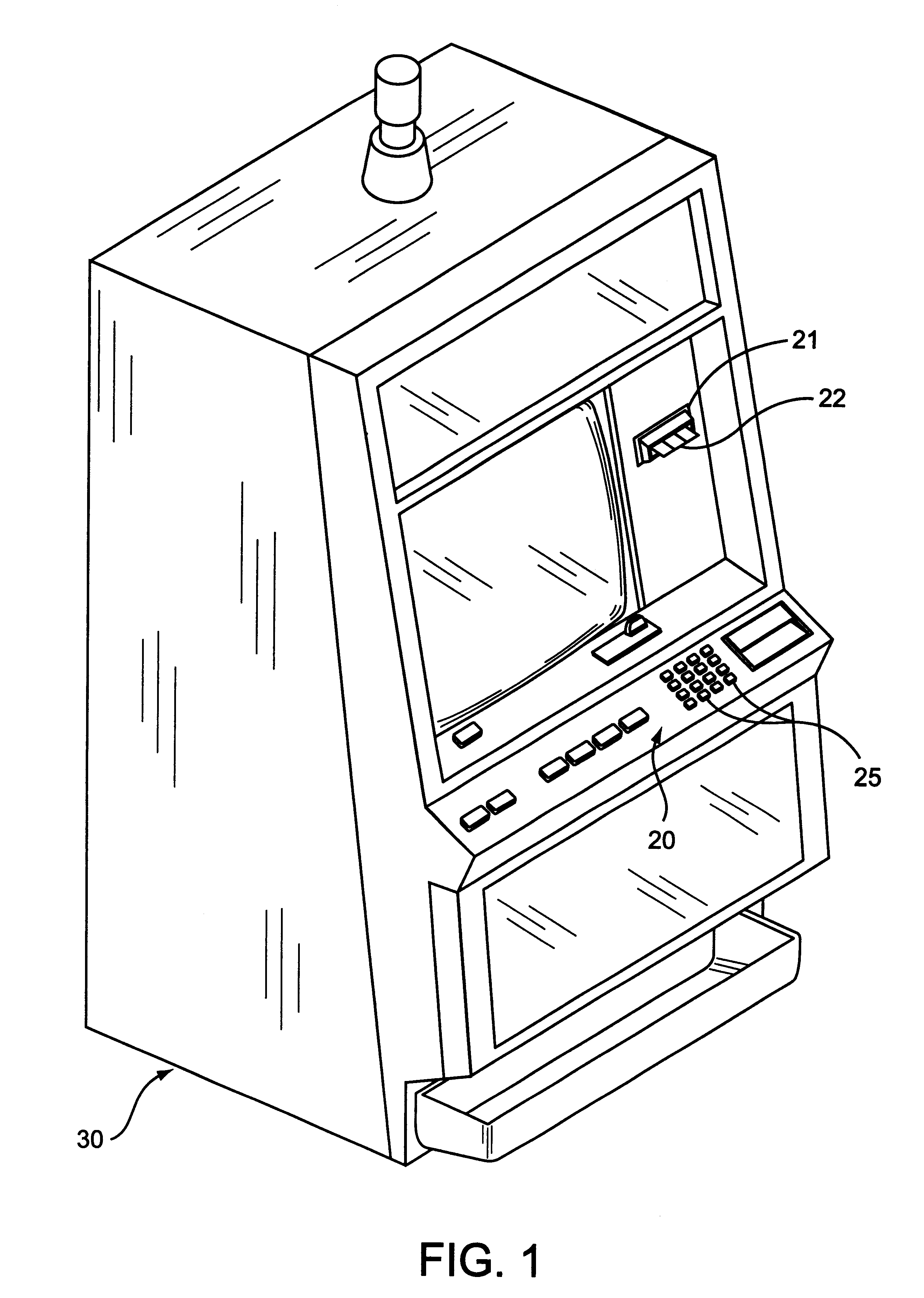

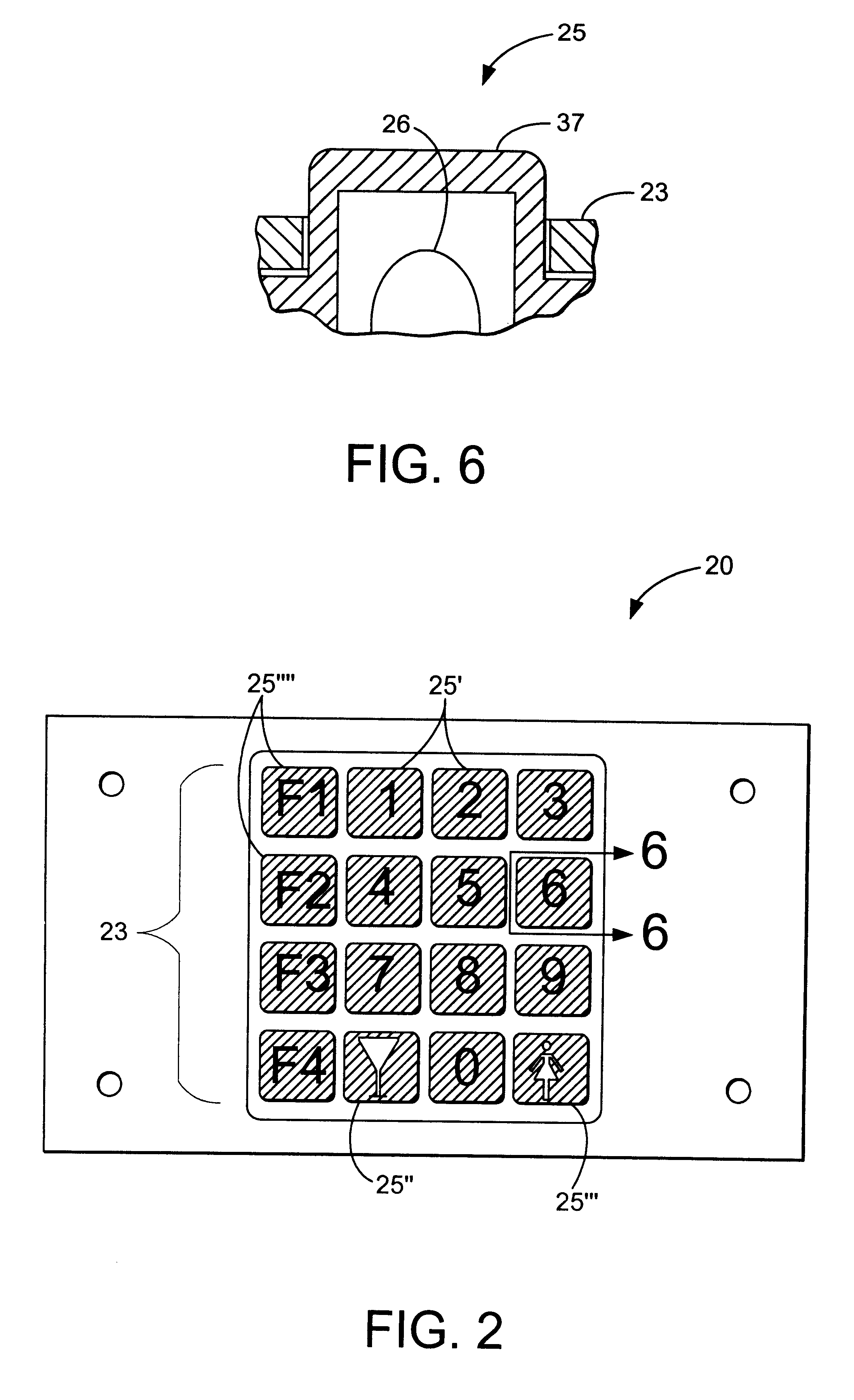

Lighted keypad assembly and method for a player tracking system

InactiveUS6409595B1Improve system efficiencyComplete banking machinesElectric/electromagnetic visible signallingCard readerTracking system

A keypad assembly and method for use with a card reader adapted to receive and read a player identification card therein. The keypad assembly includes a keypad mechanism having a plurality of keys to input data, and a feedback mechanism coupled to the keypad. A validation device is provided which is adapted to determine the validation of information relating to the identification card upon reading thereof in the card reader. The validation device is further operably coupled to the feedback mechanism to visually inform the Player that the information relating to identification card has been validated.

Owner:IGT

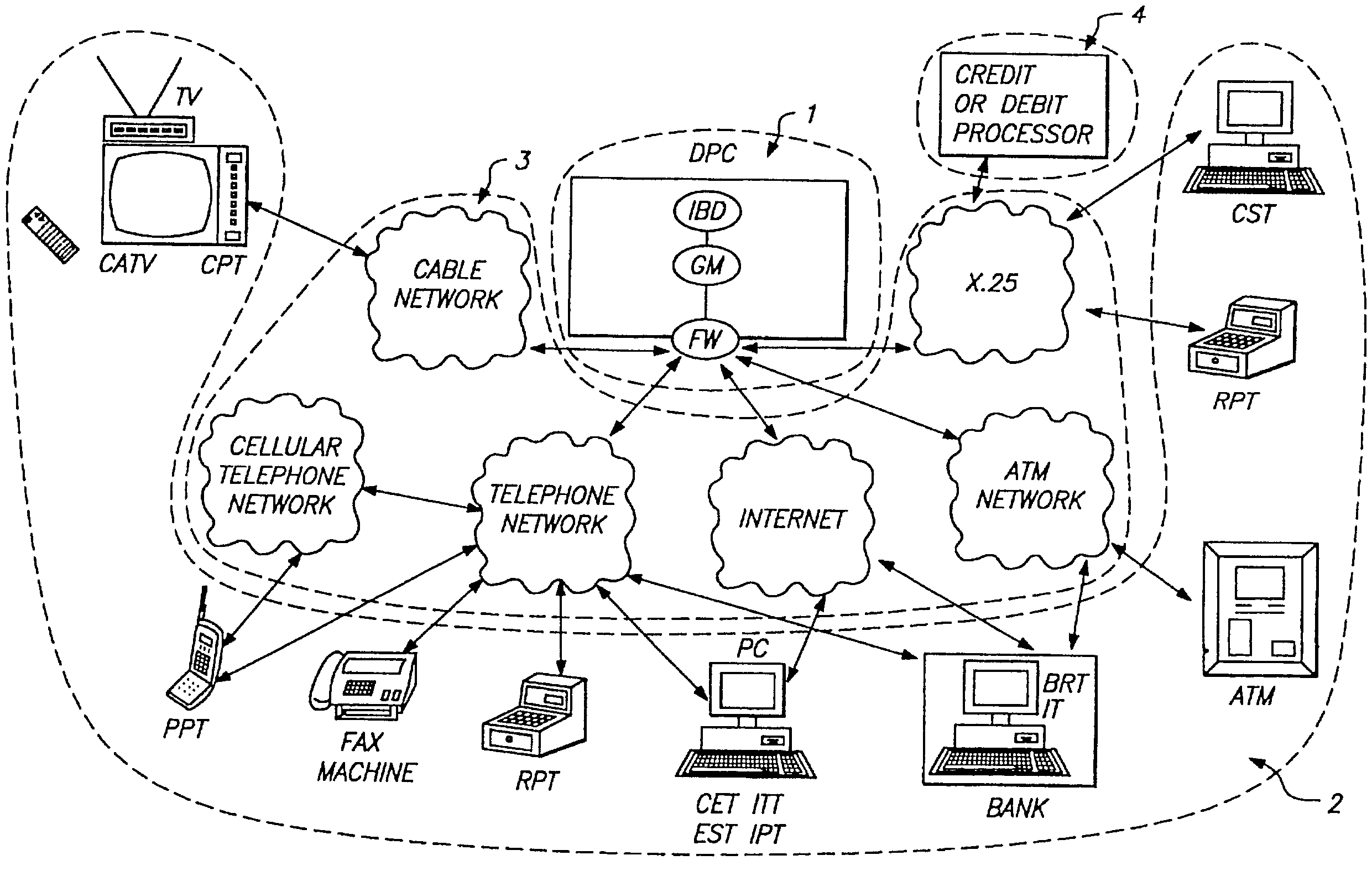

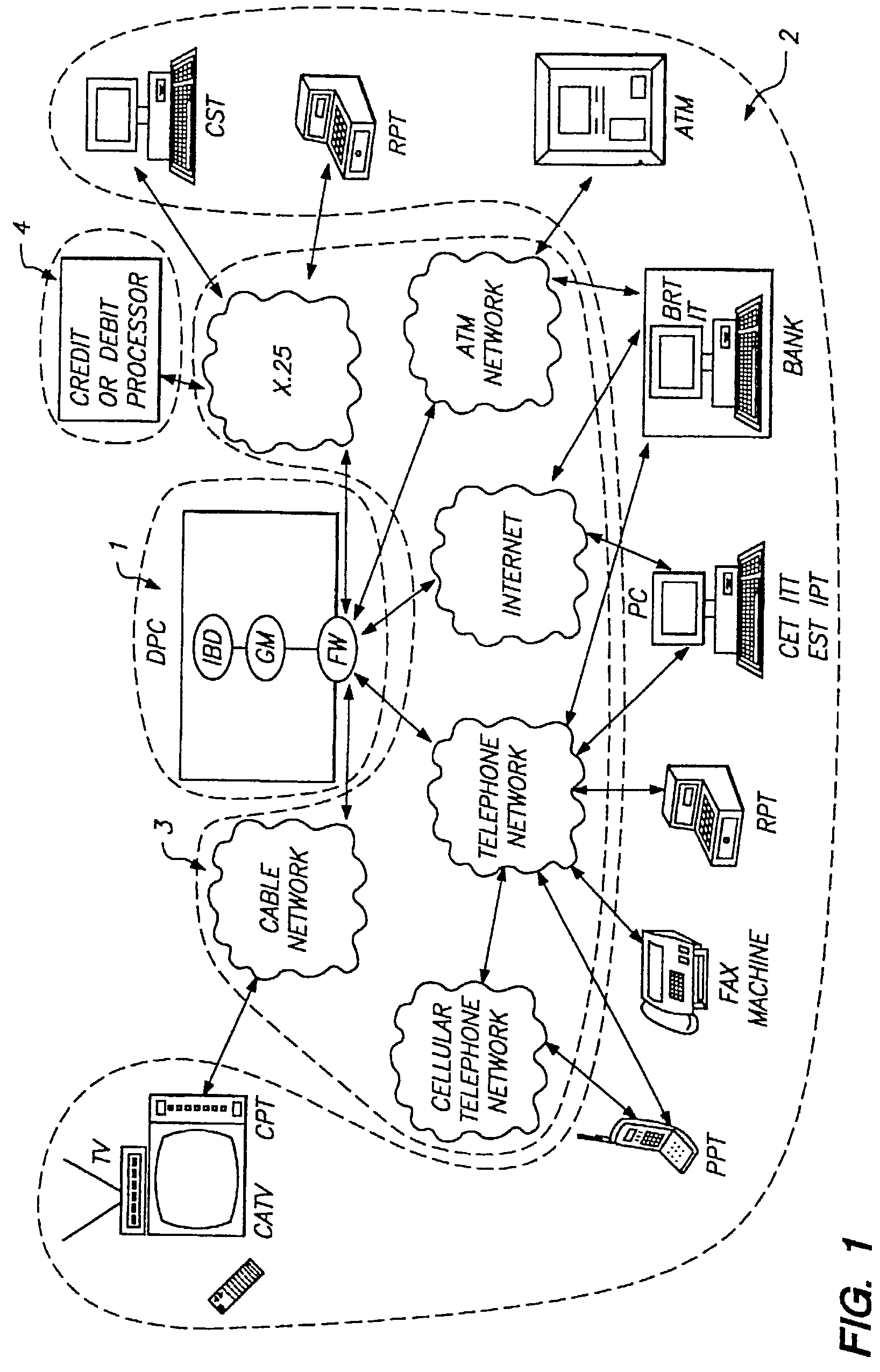

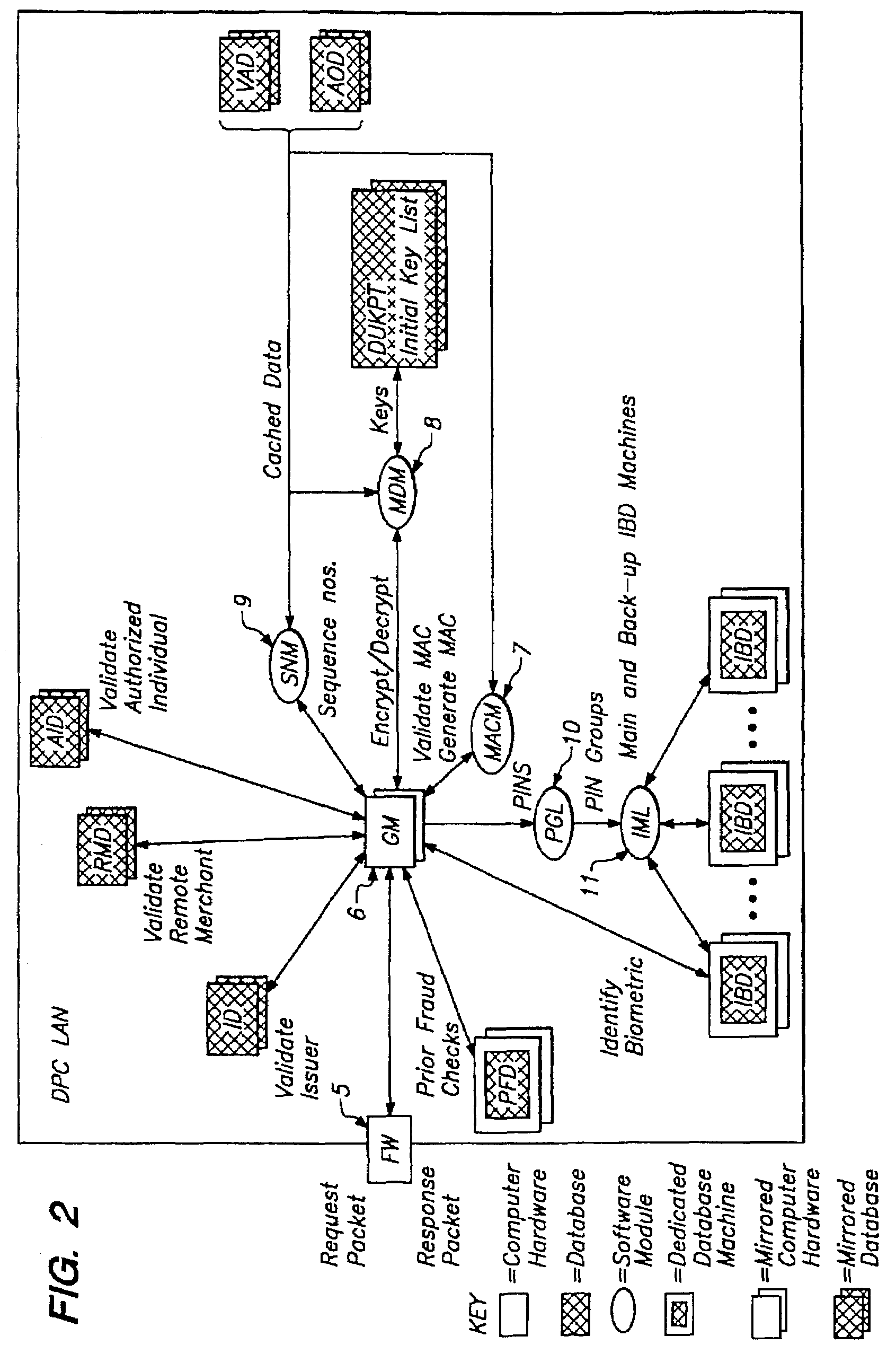

Tokenless identification system for authorization of electronic transactions and electronic transmissions

InactiveUS7152045B2Eliminate riskEnhances fraud resistanceCredit registering devices actuationDigital data processing detailsElectronic transmissionComputerized system

A tokenless identification system and method for authorization of transactions and transmissions. The tokenless system and method are principally based on a correlative comparison of a unique biometrics sample, such as a finger print or voice recording, gathered directly from the person of an unknown user, with an authenticated biometrics sample of the same type obtained and stored previously. It can be networked to act as a full or partial intermediary between other independent computer systems, or may be the sole computer systems carrying out all necessary executions. It further contemplates the use of a private code that is returned to the user after the identification has been complete, authenticating and indicating to the user that the computer system was accessed. The identification system and method of additionally include emergency notification to permit an authorized user to alert authorities an access attempt is coerced.

Owner:EXCEL INNOVATIONS +1

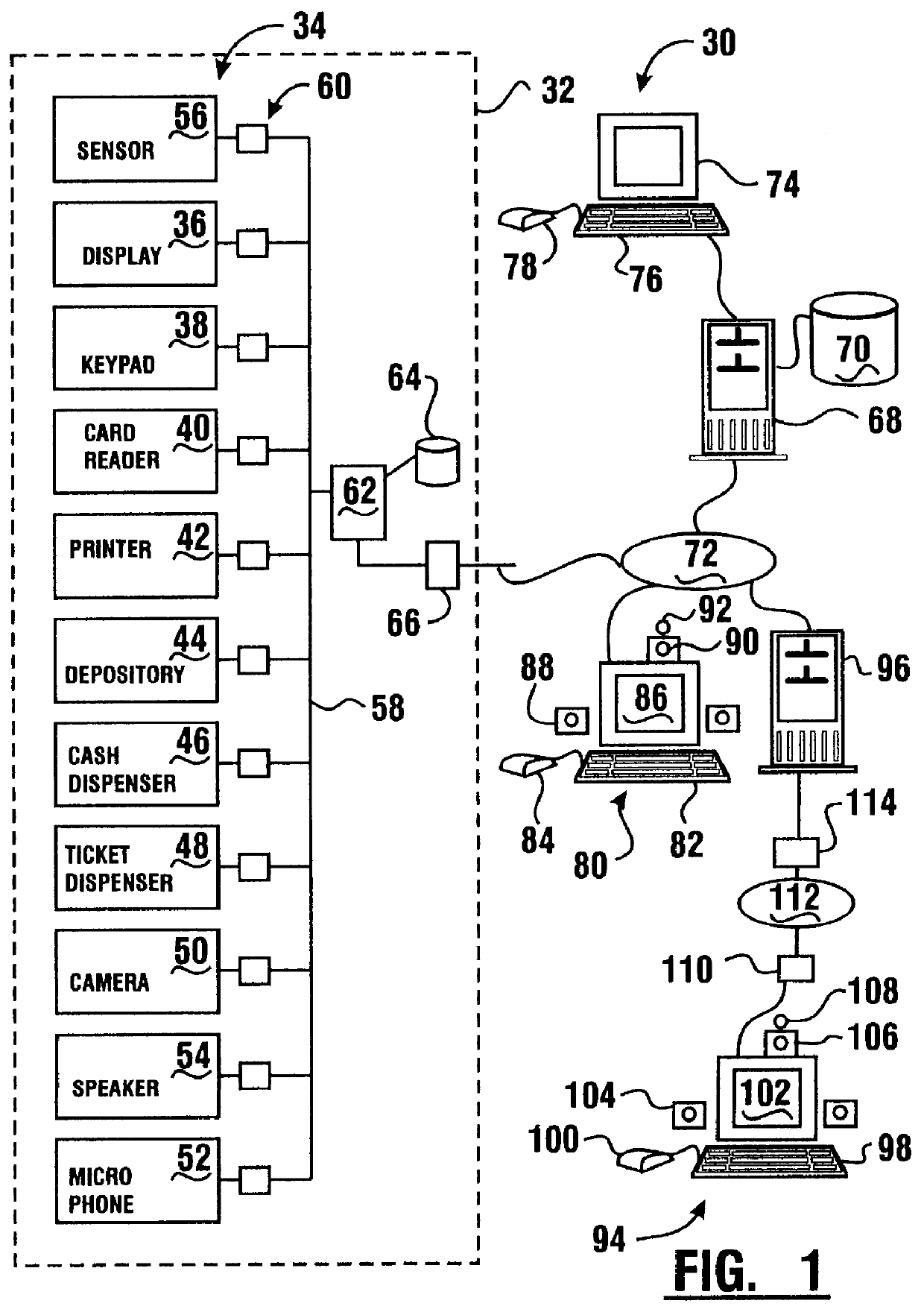

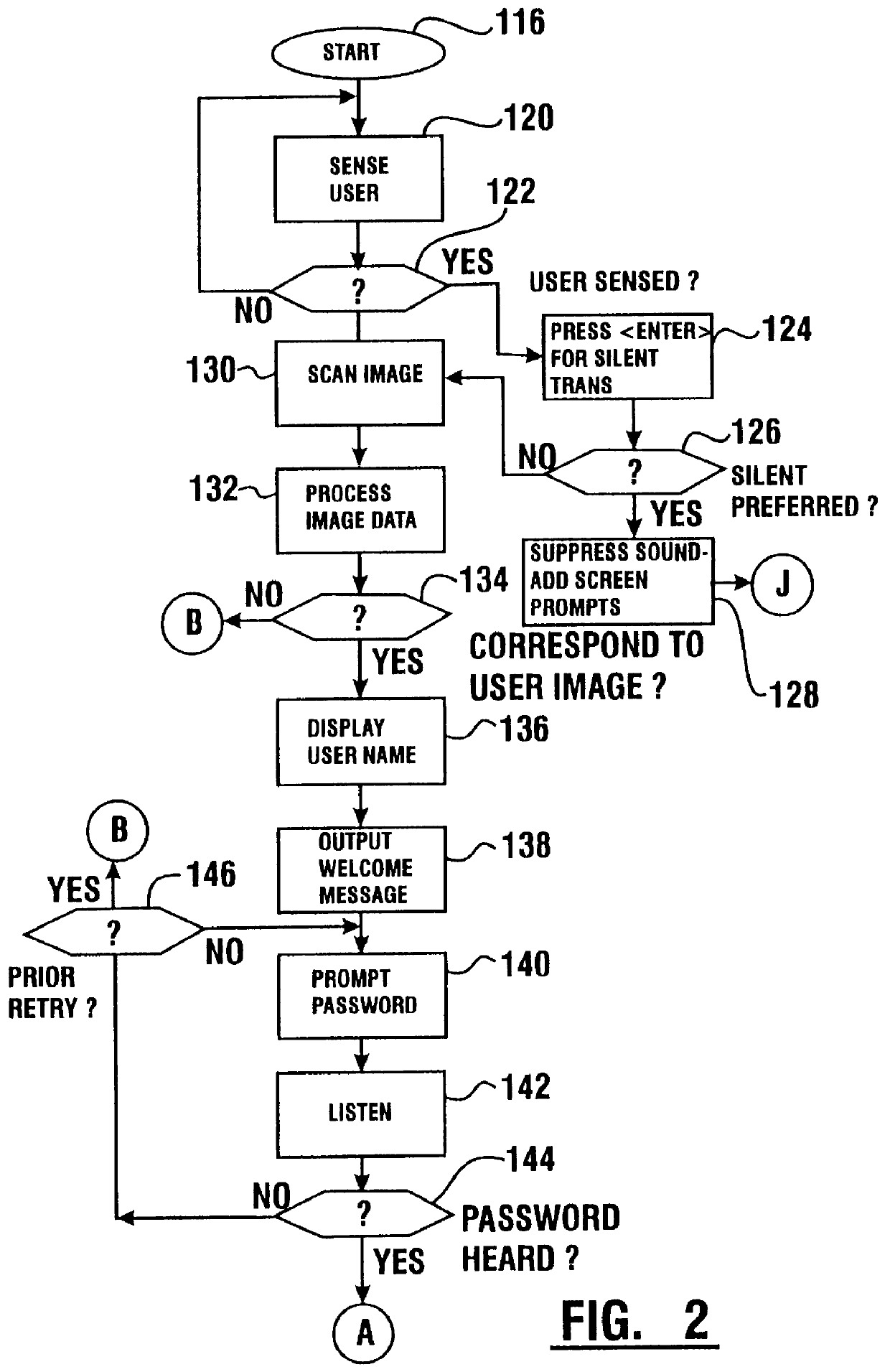

Transaction apparatus and method that identifies an authorized user by appearance and voice

A financial transaction apparatus (30) includes a financial transaction machine (32). The machine includes devices (34) including transaction function devices (42, 44, 46, 48) for carrying out operations associated with financial transactions. The terminal also includes an imaging device (50) and an audio input device (52), as well as a visual output device (36) and an audio output device (54). Terminal (32) is connected to a computer (68) which has an associated data store (70). The data store includes user data including image data and voice data corresponding to authorized users. The identity of a customer operating the machine is determined by resolving first identity data based on image signals from the imaging device which correspond to a user's appearance. Second identity data is resolved by the processor from voice signals from the audio input device corresponding to the user's voice. The computer enables operation of the transaction function devices if the level of correlation between the first and second identity data is sufficient to establish that the image and voice signals originate from a single authorized user.

Owner:DIEBOLD NIXDORF

Automated banking apparatus and method

InactiveUS20040016796A1Accurate specificationsGood user interfaceComplete banking machinesCoin/currency accepting devicesFinancial transactionCheque

An automated banking apparatus is operative to carry out banking transactions commonly required by merchants. The apparatus includes an item accepting depository for accepting deposit items, such as deposit bags, currency, and checks. The apparatus further includes an input device that is operative to interrogate an RFID tag to obtain merchant deposit information therefrom. The information can include data representative of the deposit, such as an account number and the deposit amount. The RFID tag may be located on an item being deposited.

Owner:DIEBOLD NIXDORF

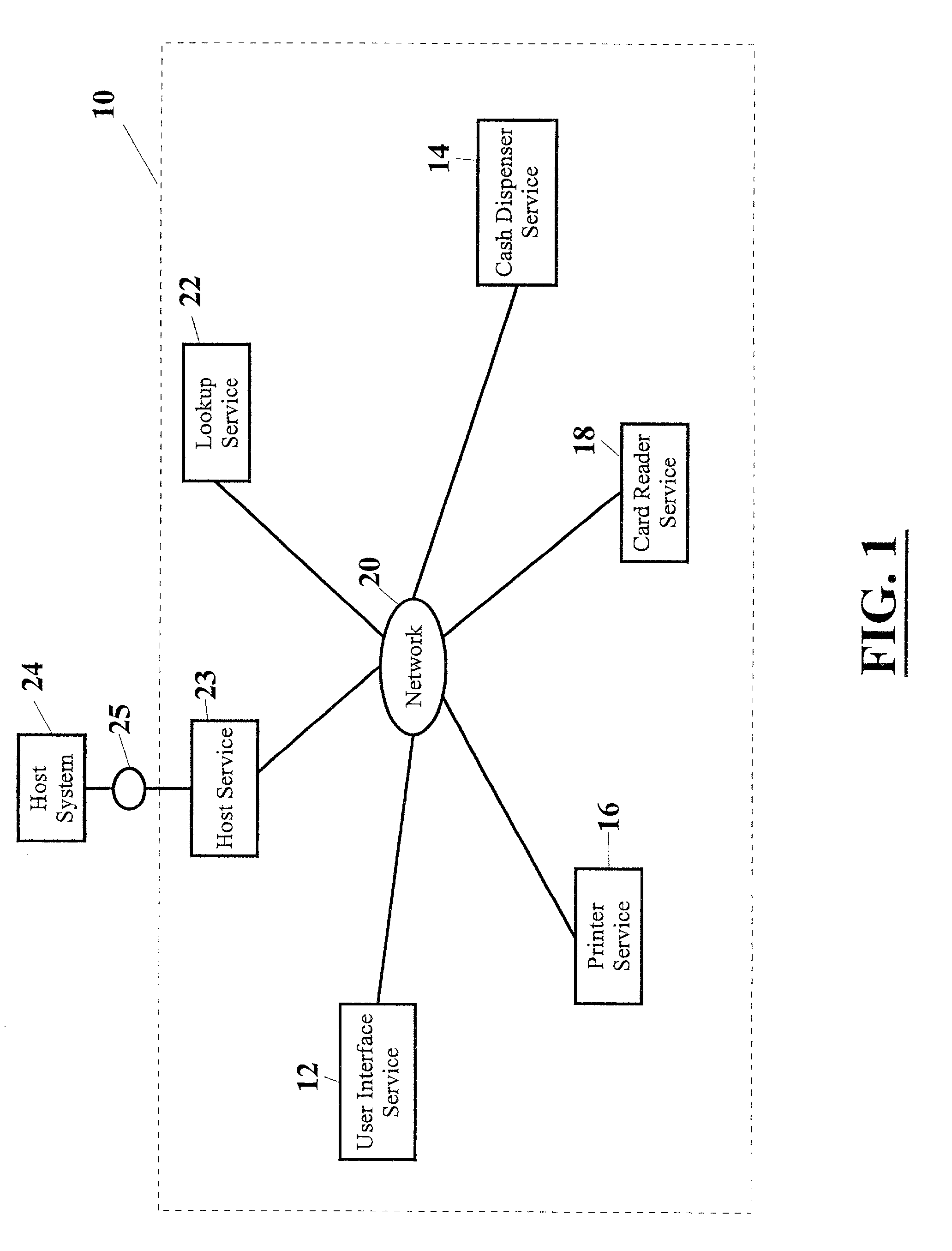

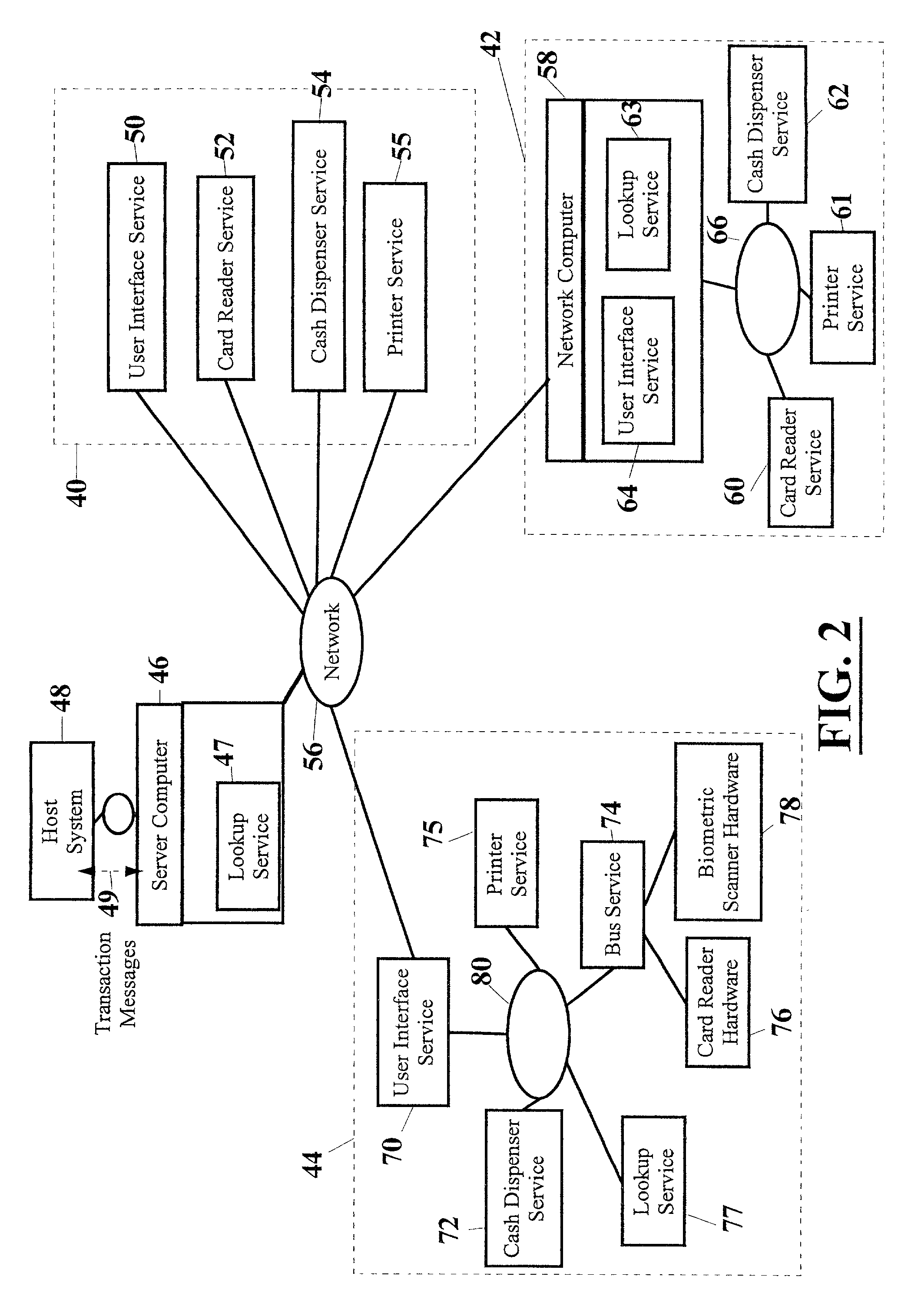

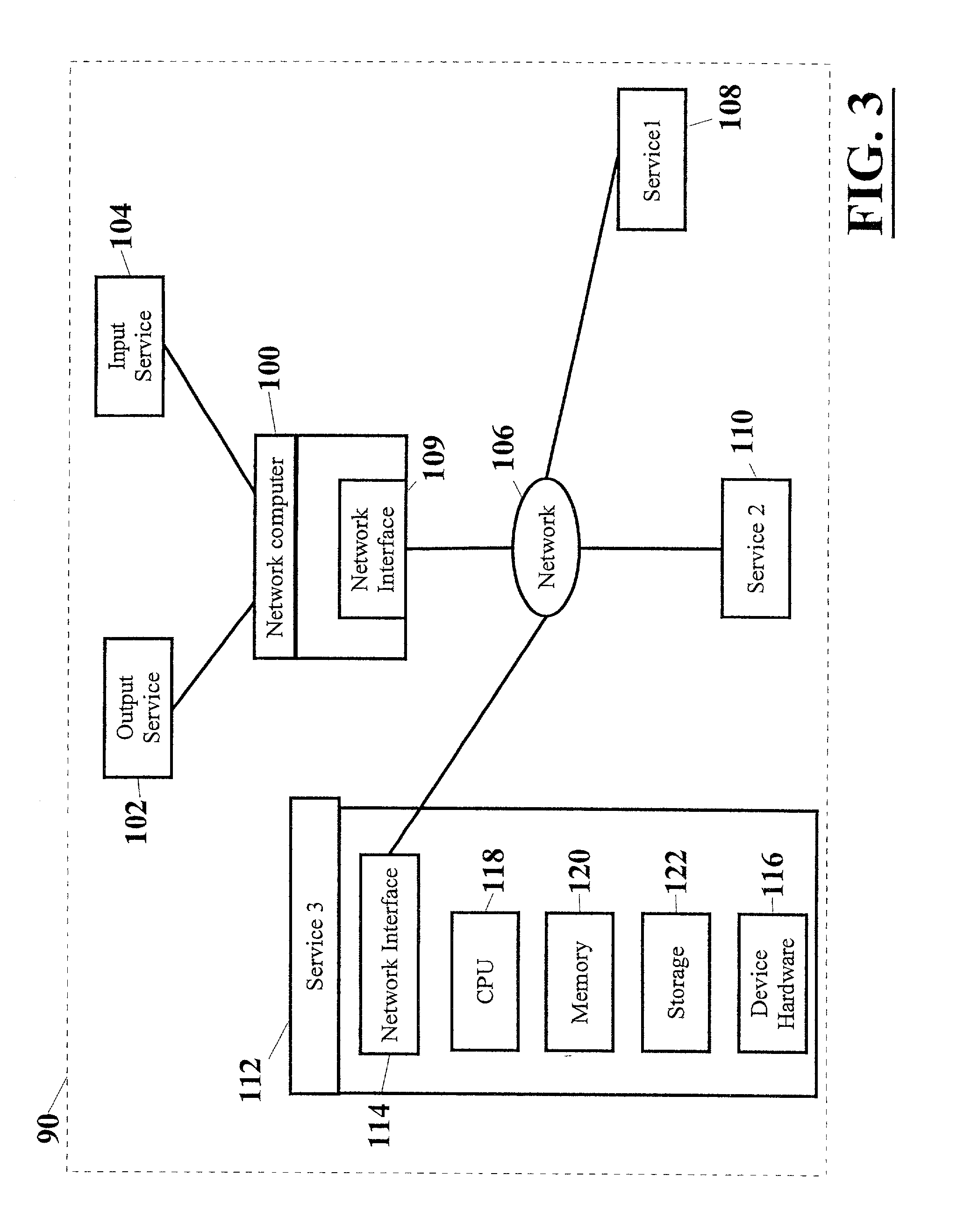

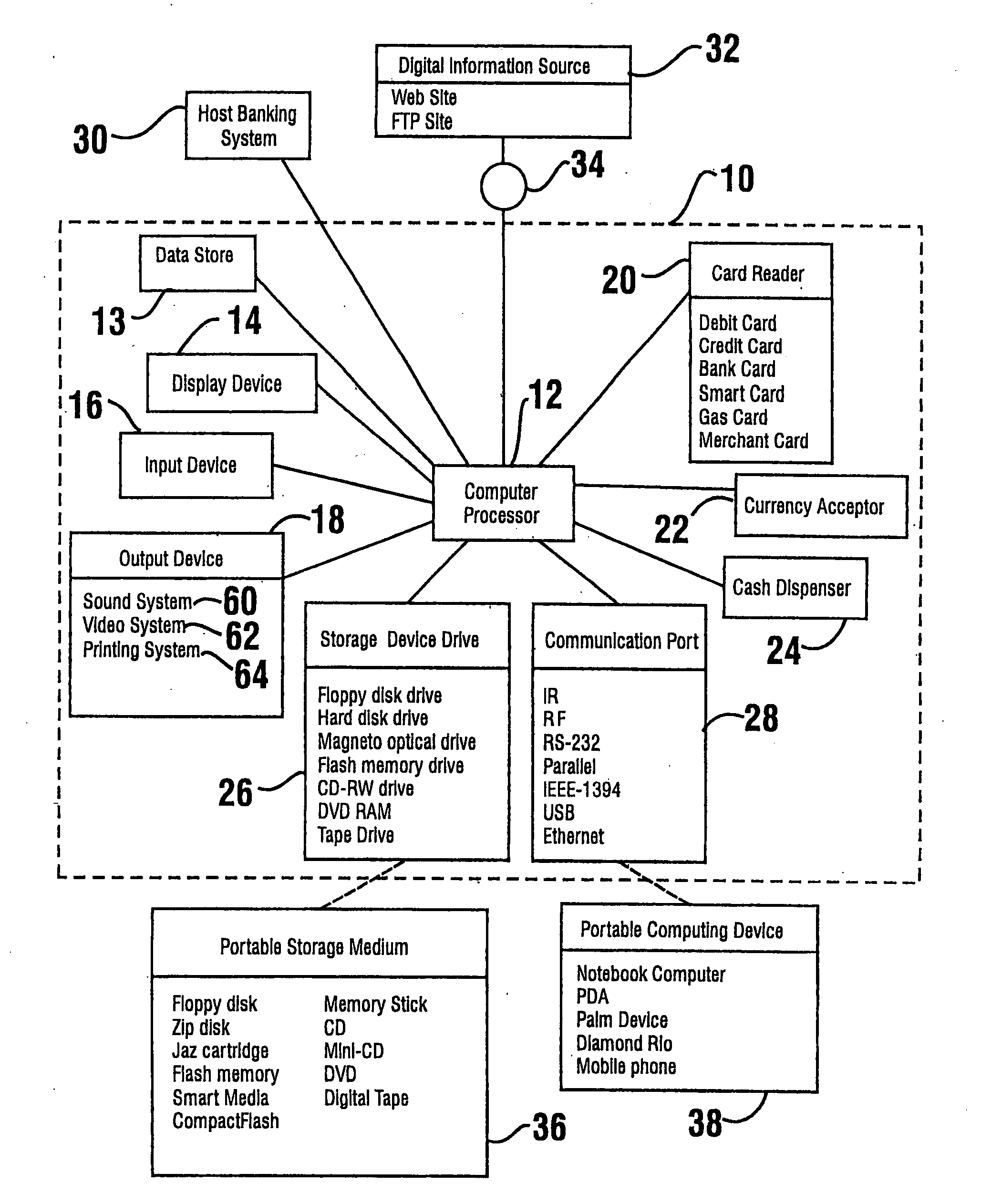

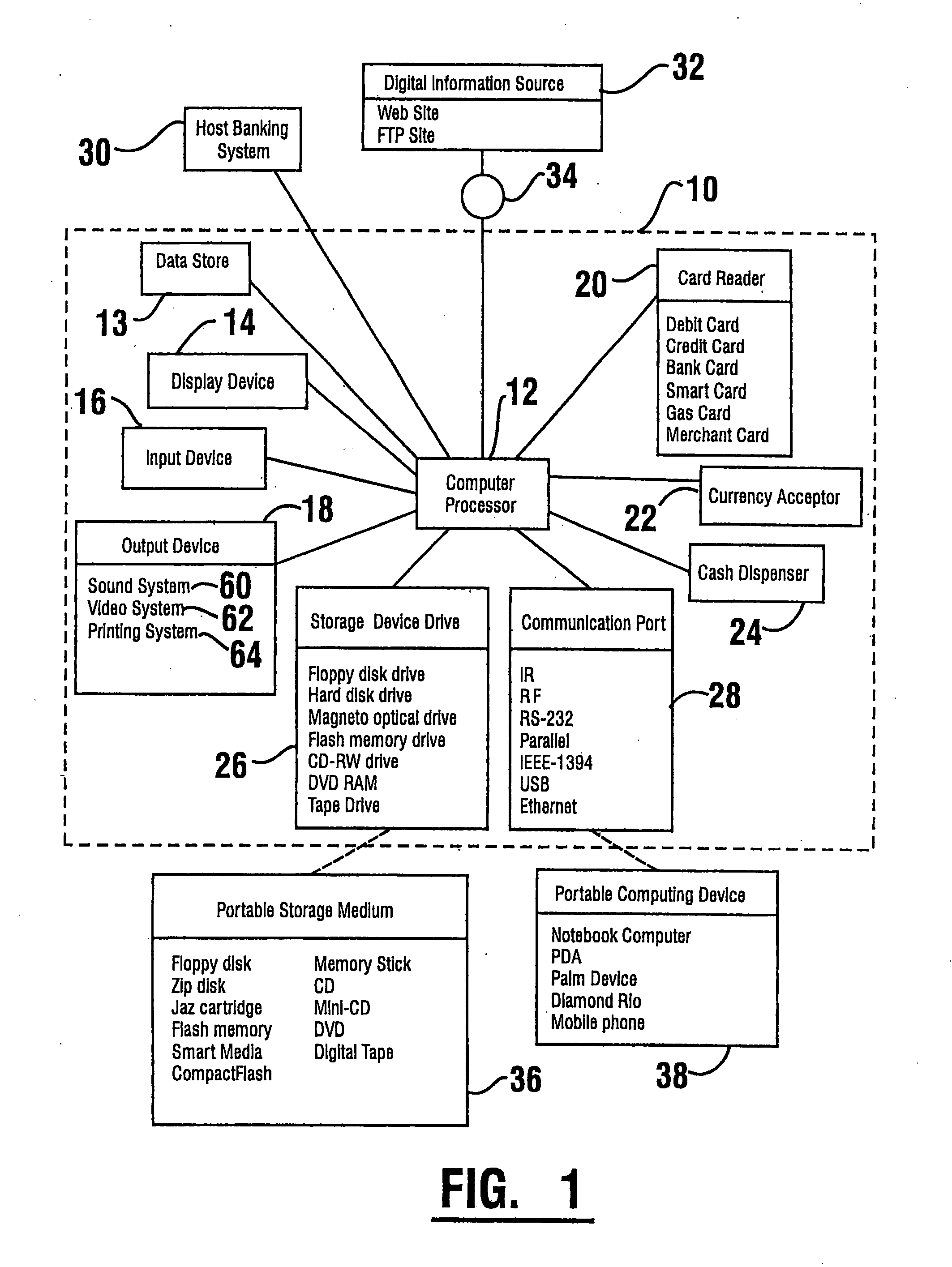

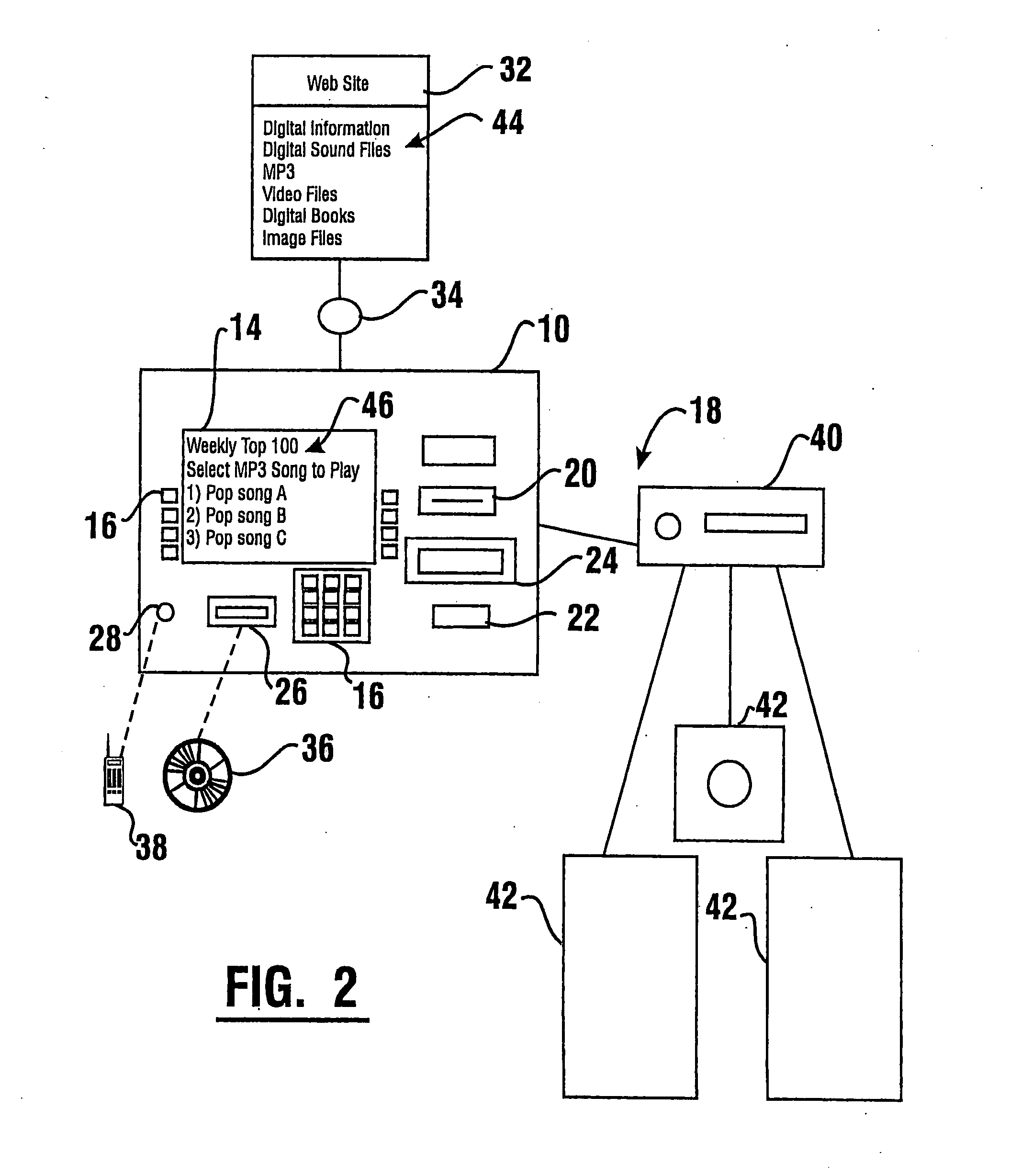

Automated transaction machine and method

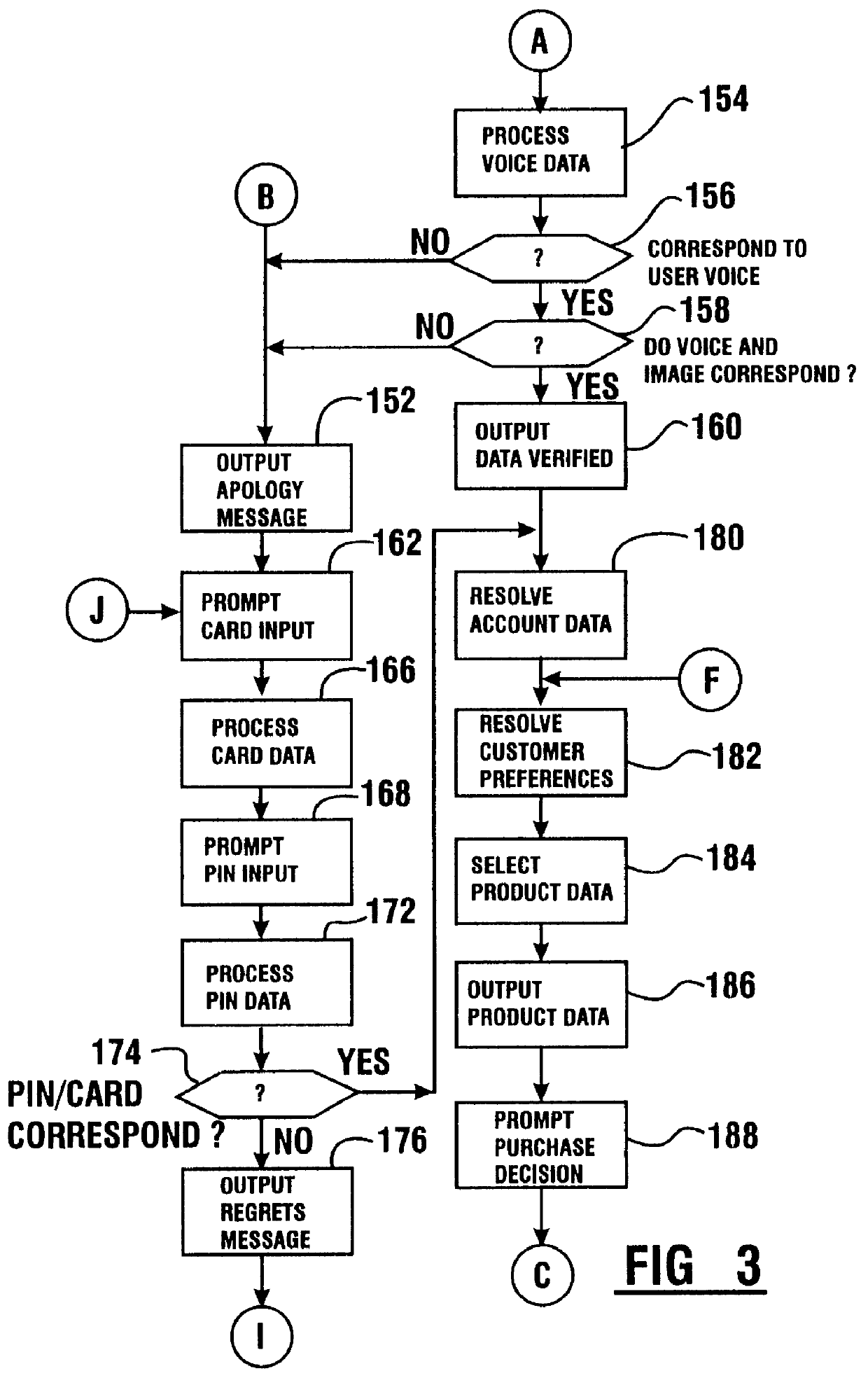

InactiveUS20010014881A1Firmly connectedExtension of timeComplete banking machinesFinanceTransaction serviceCard reader

A system for connecting transaction services to an ATM (10, 500) that includes a network (20). A user interface service (12) and a lookup service (22) are in operative connection with the network. Transaction services such as a printer service (16), card reader service (18), and cash dispenser service (14) are also in operative connection with the network. These transaction services are operative to register with the lookup service and to upload a service proxy to the lookup service. The user interface service is operative to locate transaction services on the network by invoking a remote lookup method on the lookup service. The lookup service is operative to return service proxies that match the type of service that is required. The user interface service is further operative to invoke methods of the service proxies that remotely control the functionality of the transaction services on the network. The user interface service is further operative to register events with the service proxies for notification when certain events on the services occur.

Owner:DIEBOLD NIXDORF

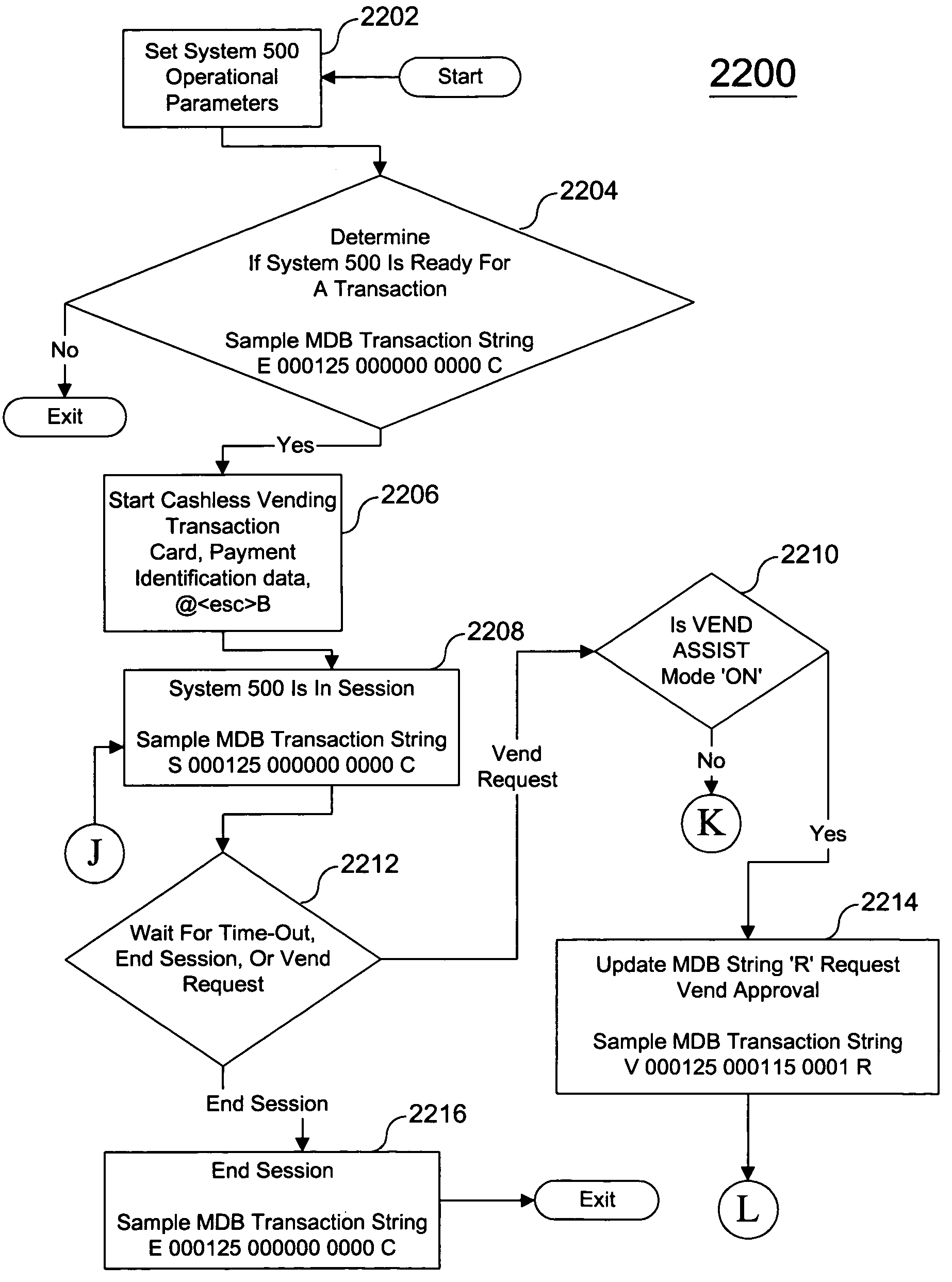

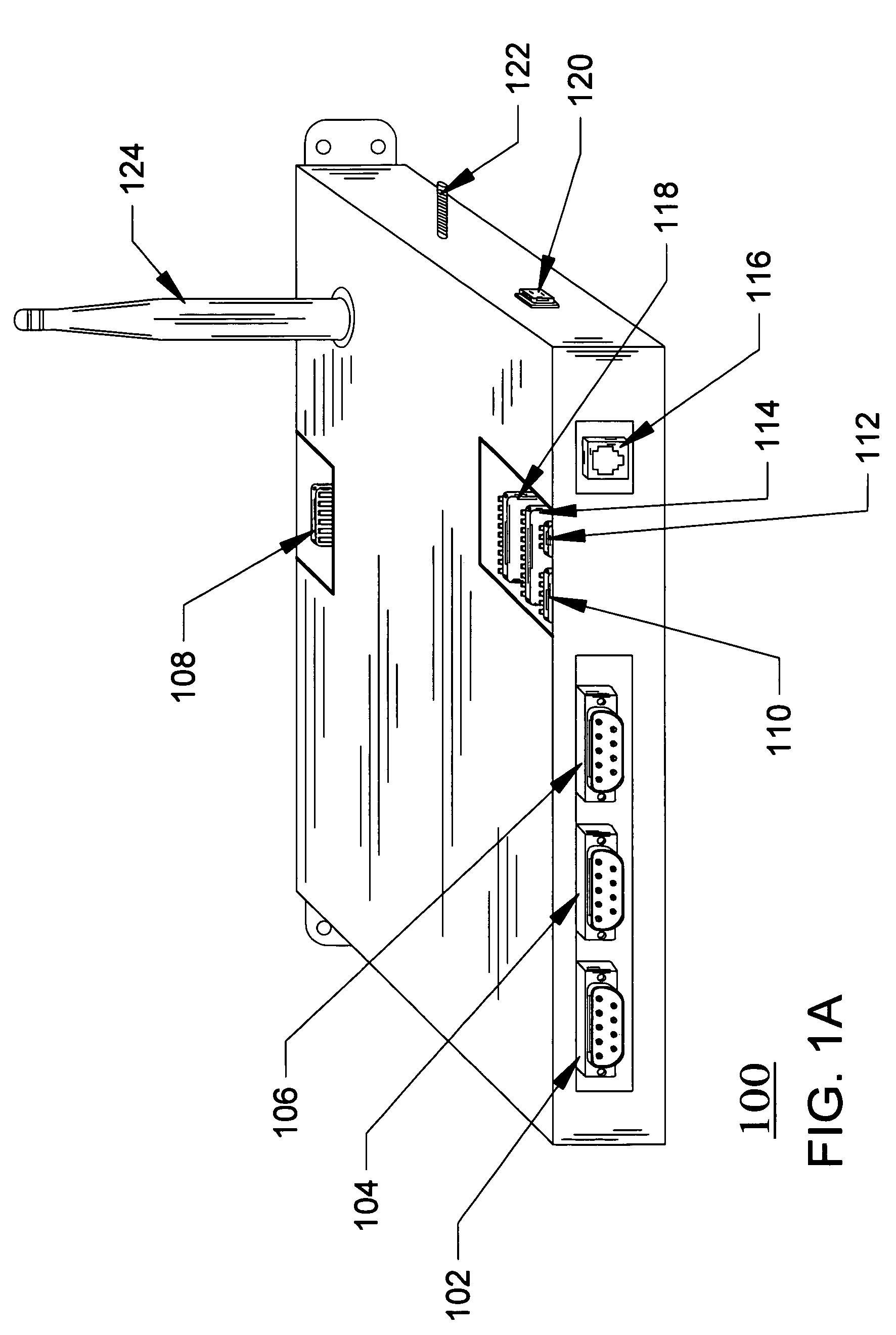

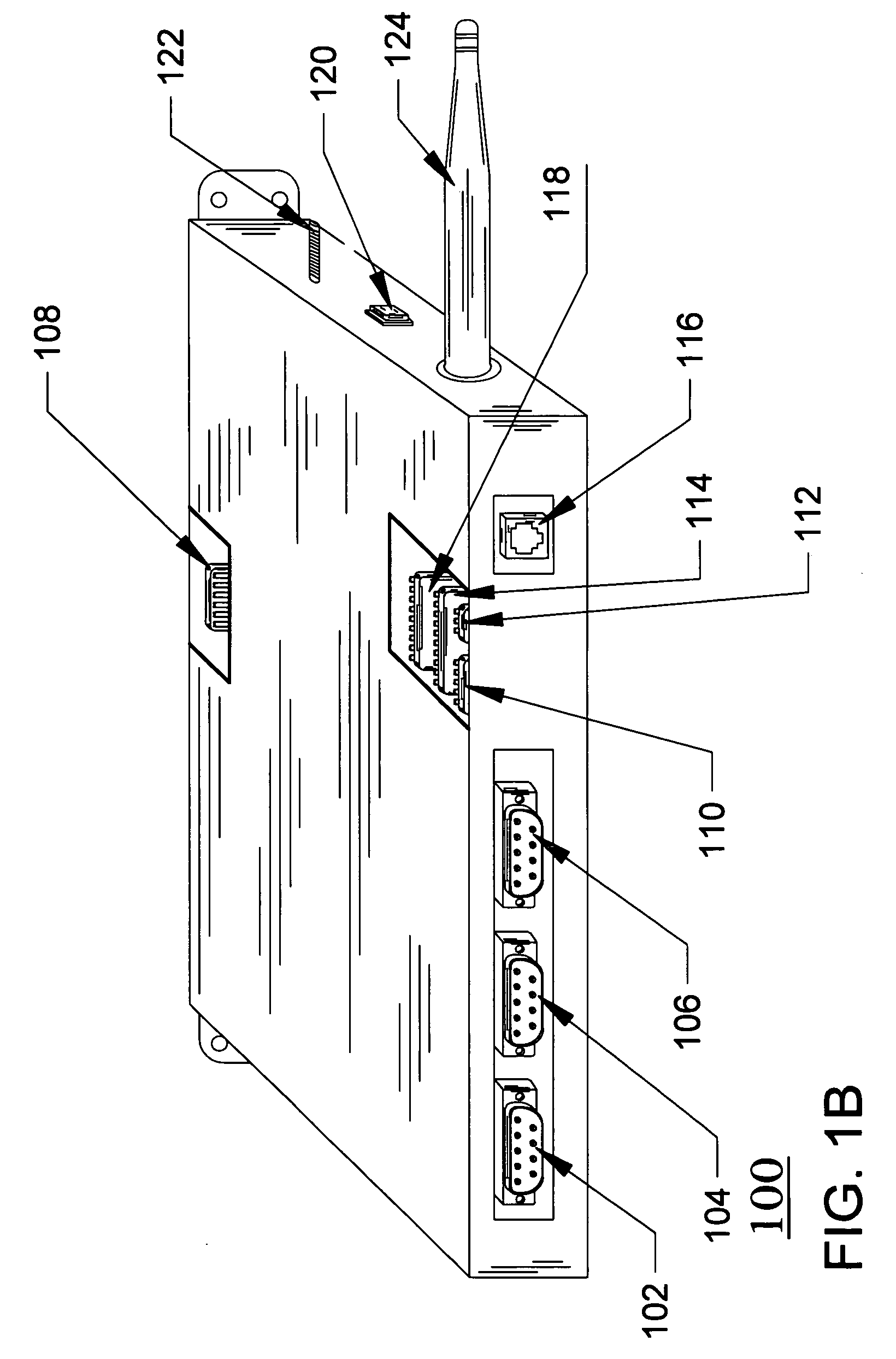

Cashless vending transaction management by a vend assist mode of operation

InactiveUS7076329B1International currency conversion processing fees are minimizedApparatus for meter-controlled dispensingAutomatic teller machinesPaymentTransaction management

The present invention relates to a cashless transaction processing system implementing a VEND ASSIST mode of operation to effectuate a cashless vending transaction. The VEND ASSIST mode allows a computing platform 802 to oversee, control, and authorize by way of a system 500 the vend selection and sale price of a user selected vend item prior to fulfilling the user's request.The cashless transaction processing system includes a system 500 and a computing platform 802. The system 500 initiates a vending session when certain commands from an interconnected computing platform 802 are received or in response to presentation, by a user, of valid payment identification data. Computing platform 802 data communicates a VEND APPROVE or VEND DENY response to a system 500 initiated REQUEST VEND APPROVE data communication. A vend cycle is then initiated or preempted as appropriate.

Owner:CANTALOUPE INC

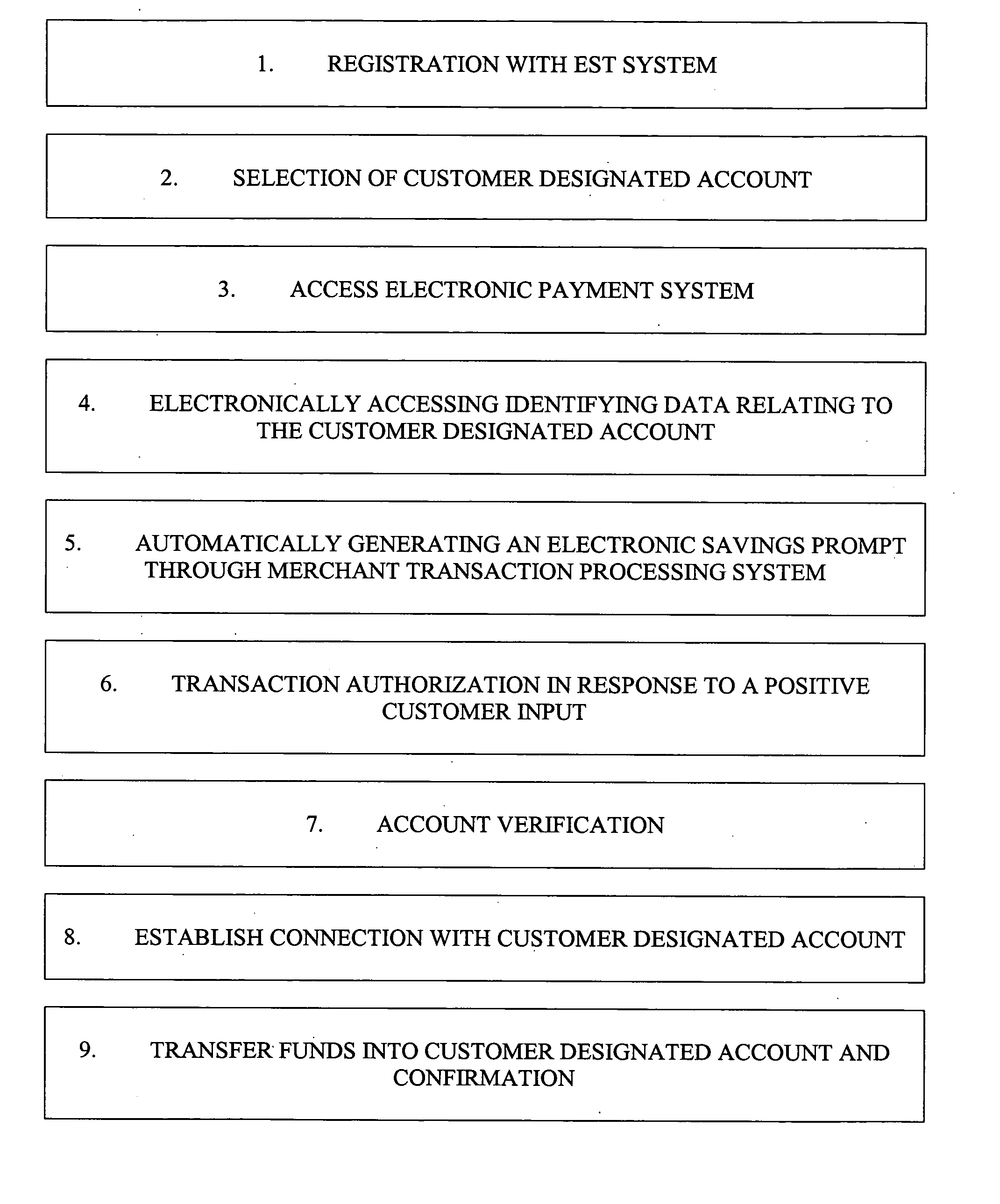

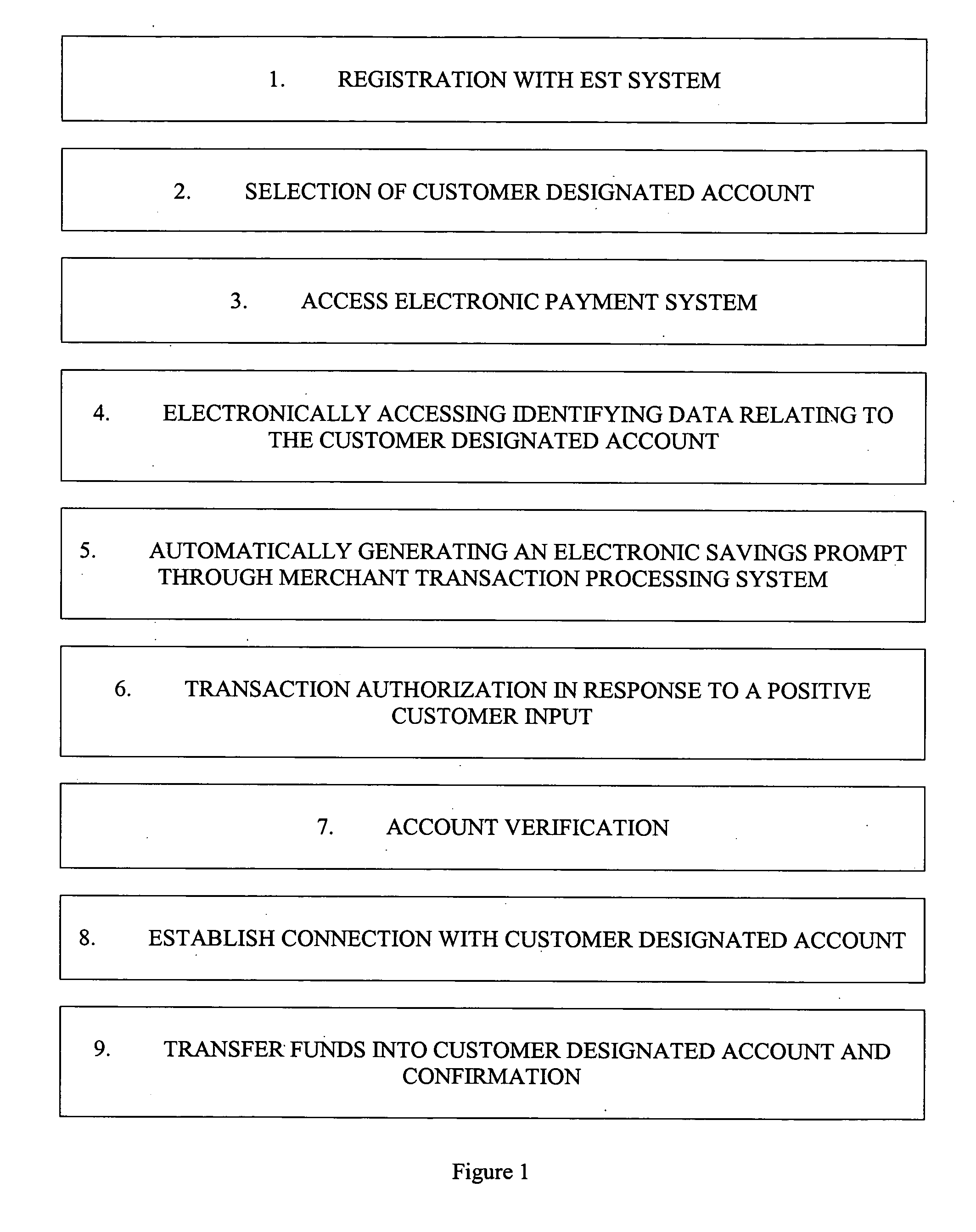

Electronic savings transfers

A system and method is provided for directing the transfer of funds to a customer designated account at a electronic payment system terminal, the method comprising the steps of: a) establishing a customer designated account capable of being accessed through the transaction processing system associated with a merchant, where the transaction processing system is communicatively linked to the customer designated account; b) accessing identifying data relating to the customer designated account through an electronic payment system terminal communicatively linked to the transaction processing system; c) automatically generating an electronic savings prompt for a customer at the electronic payment system terminal; and d) in response to a positive customer input to the savings prompt establishing a connection to the customer designated account and transferring funds into the customer designated account.

Owner:HYBRID KIOSKS

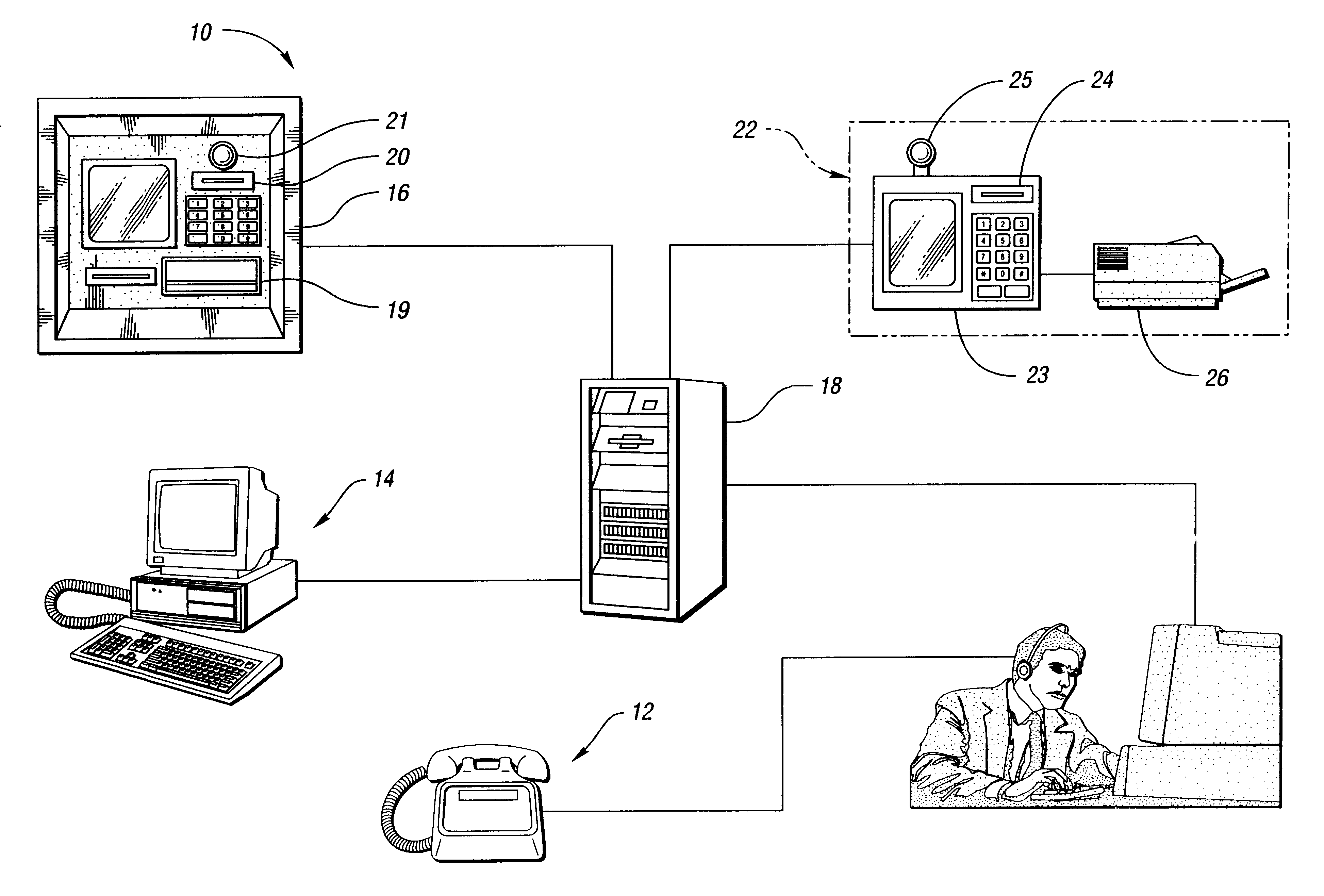

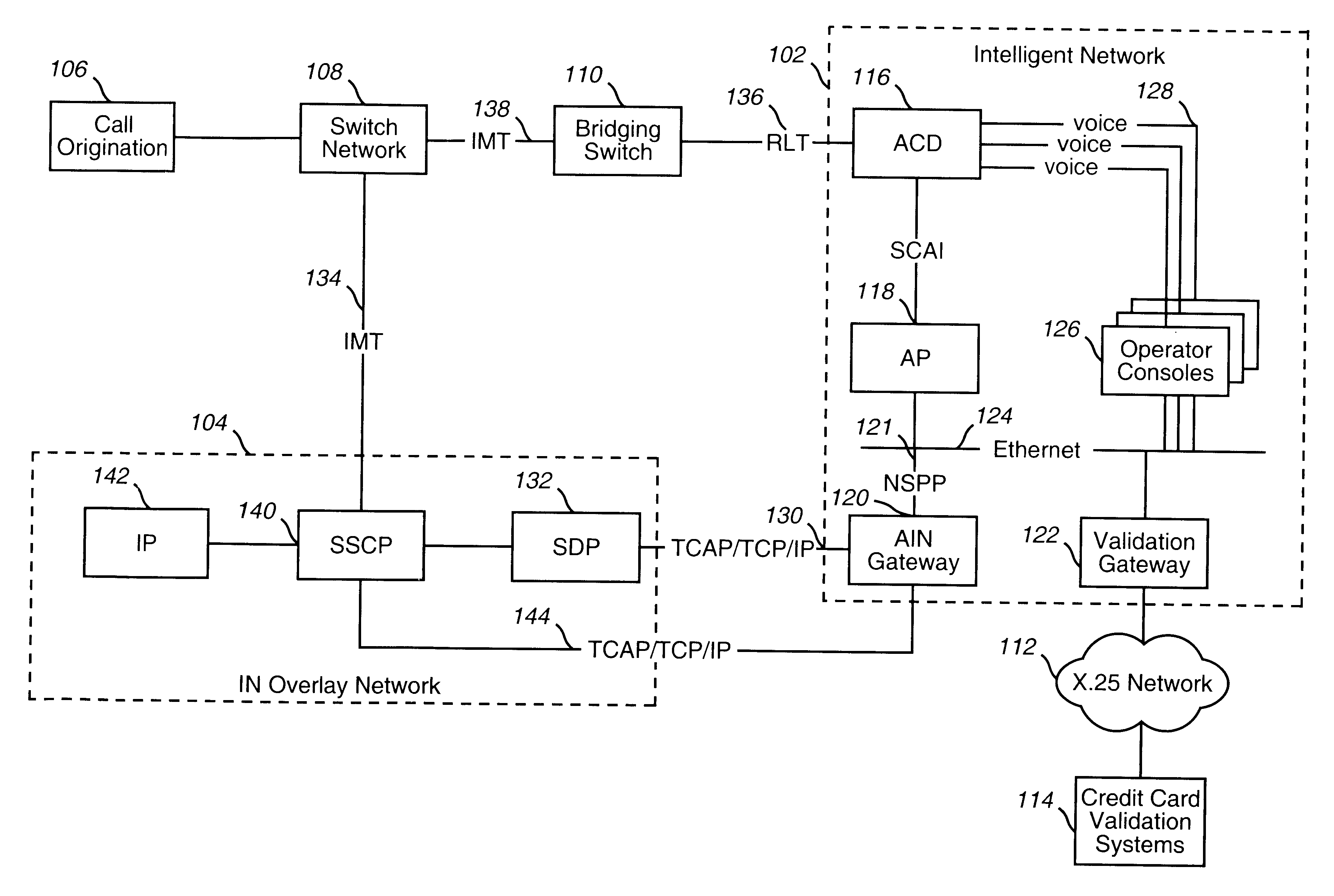

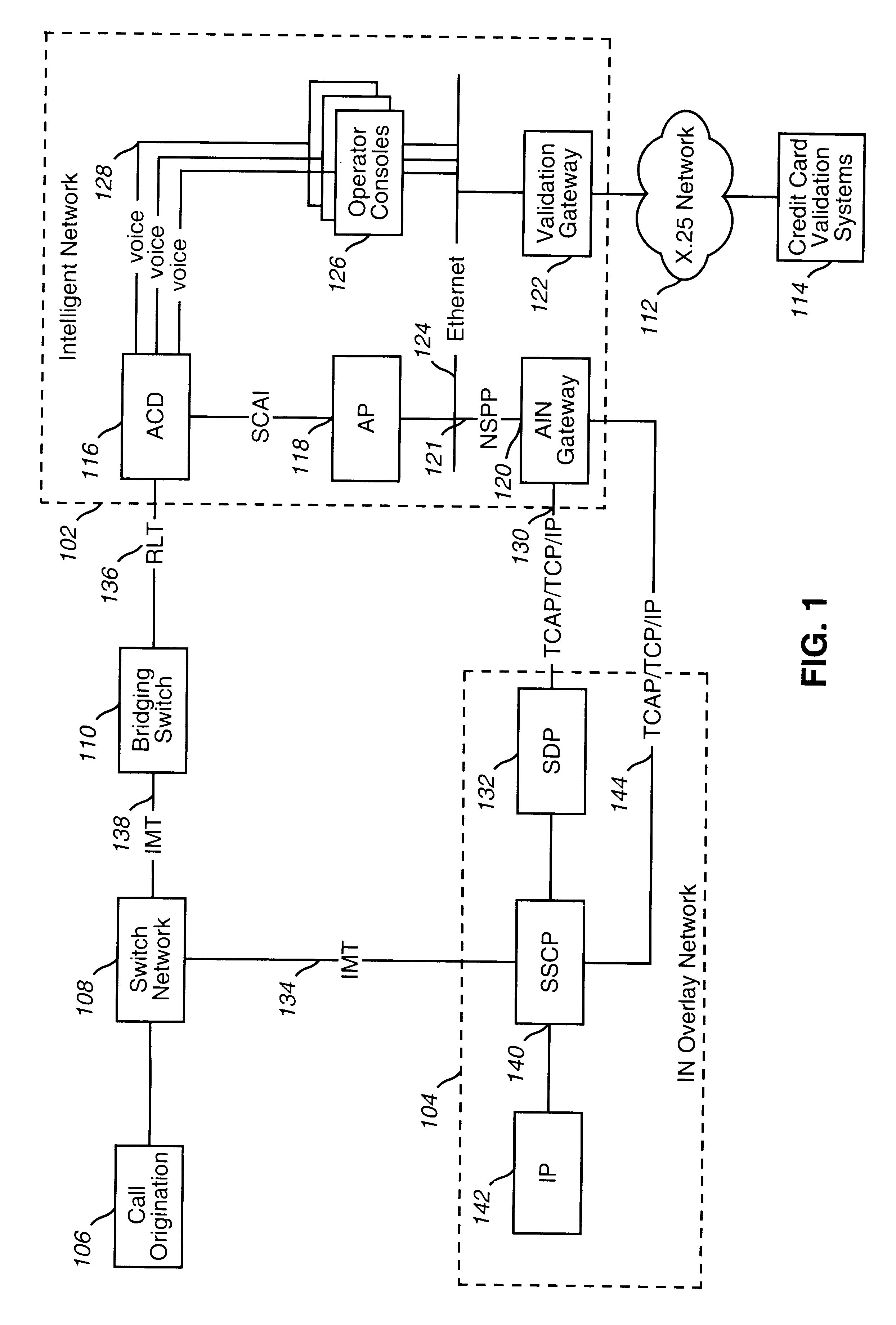

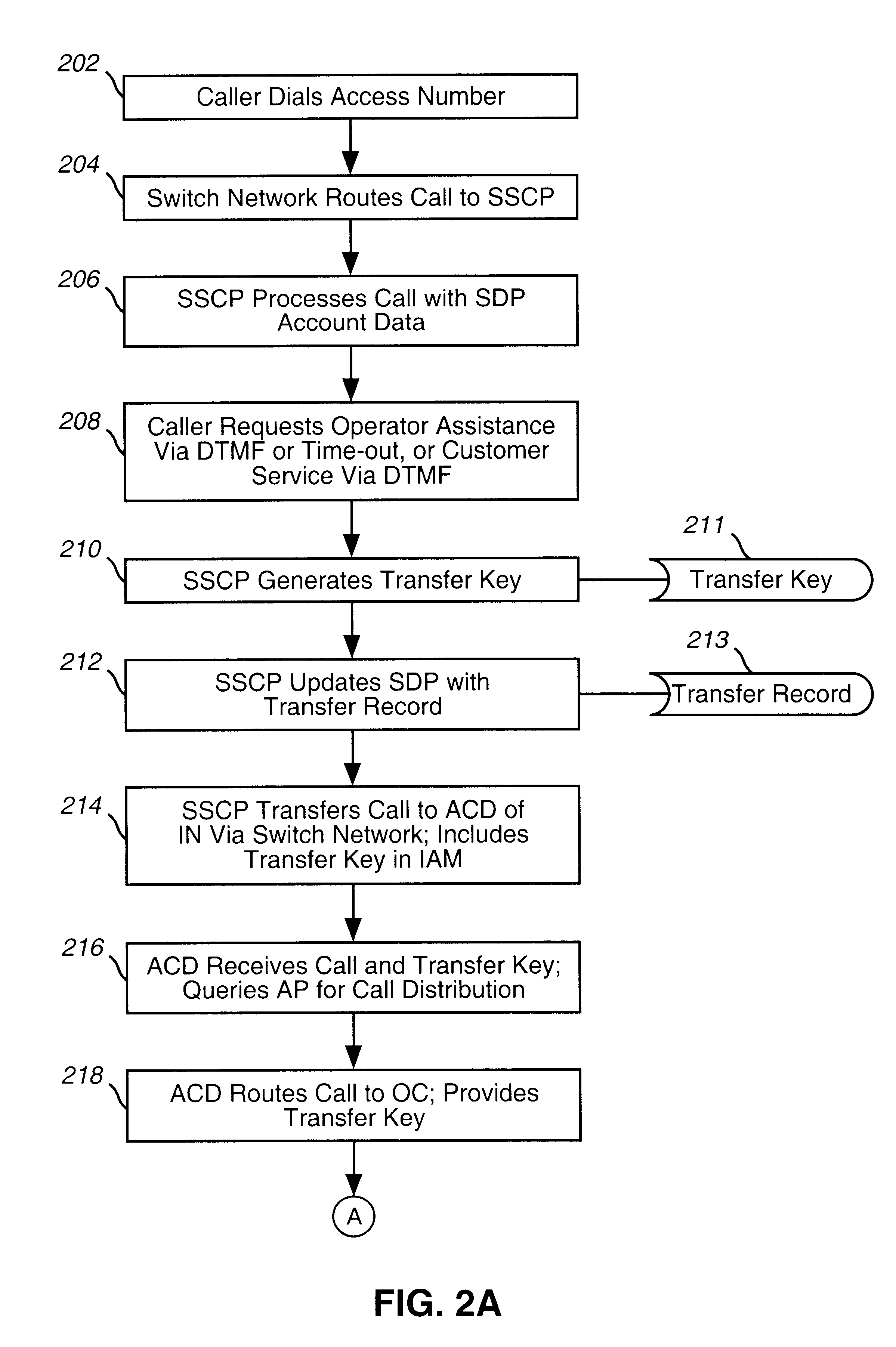

System and method for providing operator and customer services

InactiveUS6188761B1Augment automated serviceEfficiently assistComplete banking machinesInterconnection arrangementsCredit cardIntelligent Network

A system and method for providing operator and customer services for automated telecommunications services on an intelligent overlay network (104) is disclosed. Operator and customer services are provided by an intelligent network (102). The intelligent network (102) comprises an automated call distributor (116); an application processor (118); an advanced intelligent network gateway (AIN Gateway) (120); a validation gateway (122); and enhanced operator consoles (126). The AIN Gateway provides the intelligent network with an interface to the intelligent overlay network. This allows components within the intelligent network to communicate with components in the intelligent overlay network, and vice-versa. The validation gateway provides the intelligent network with an interface to credit card validation systems (114), and is used to apply charges to customer credit cards. Enhanced operator consoles provide for efficient and seamless integration of operator and customer services to automated services running on the intelligent overlay network. Such enhanced operator consoles are provided in the form of customized application programs that are executed by the operator consoles based on the context of calls that are transferred from the intelligent overlay network.

Owner:VERIZON PATENT & LICENSING INC

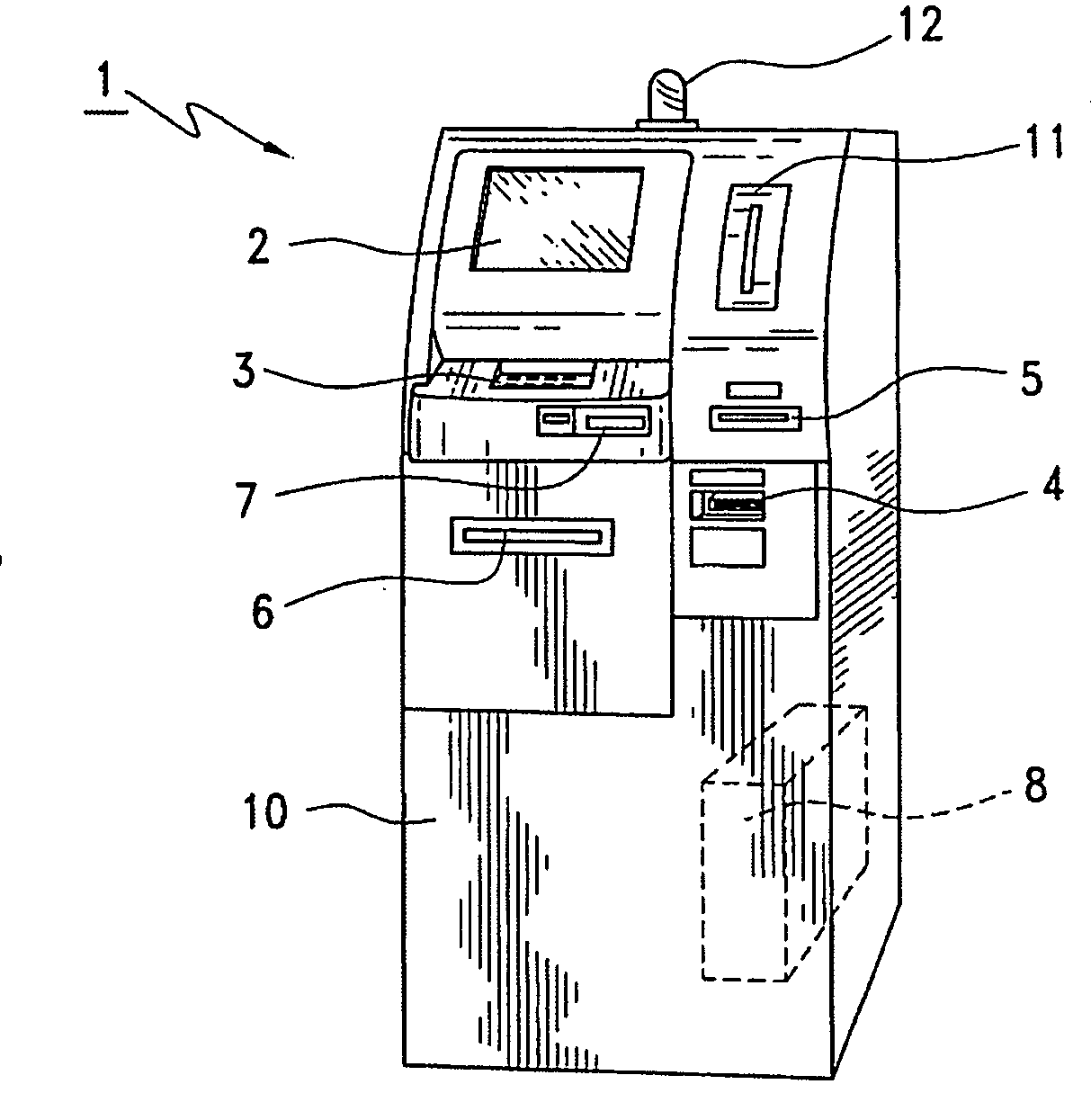

Service method for automated banking machine

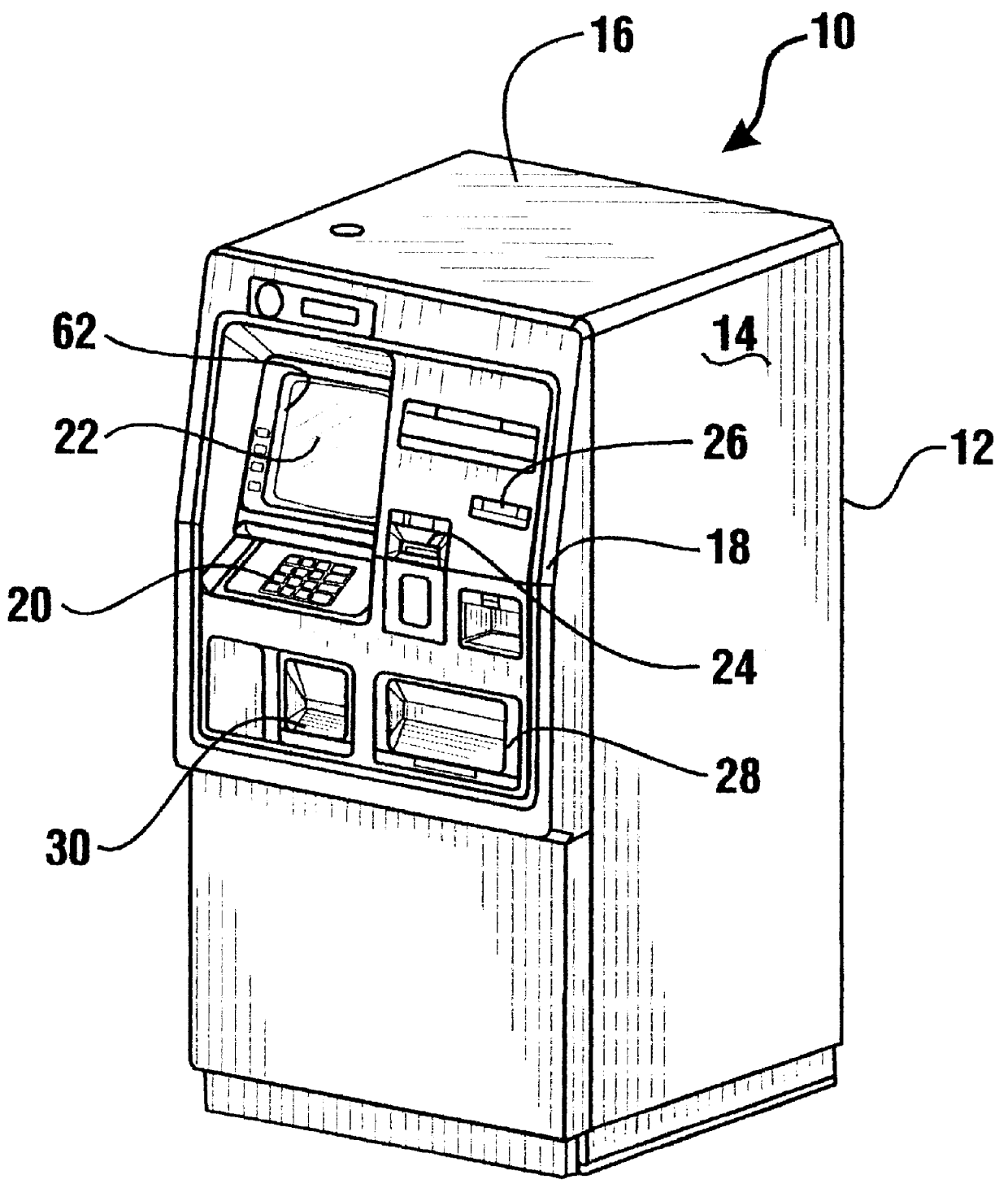

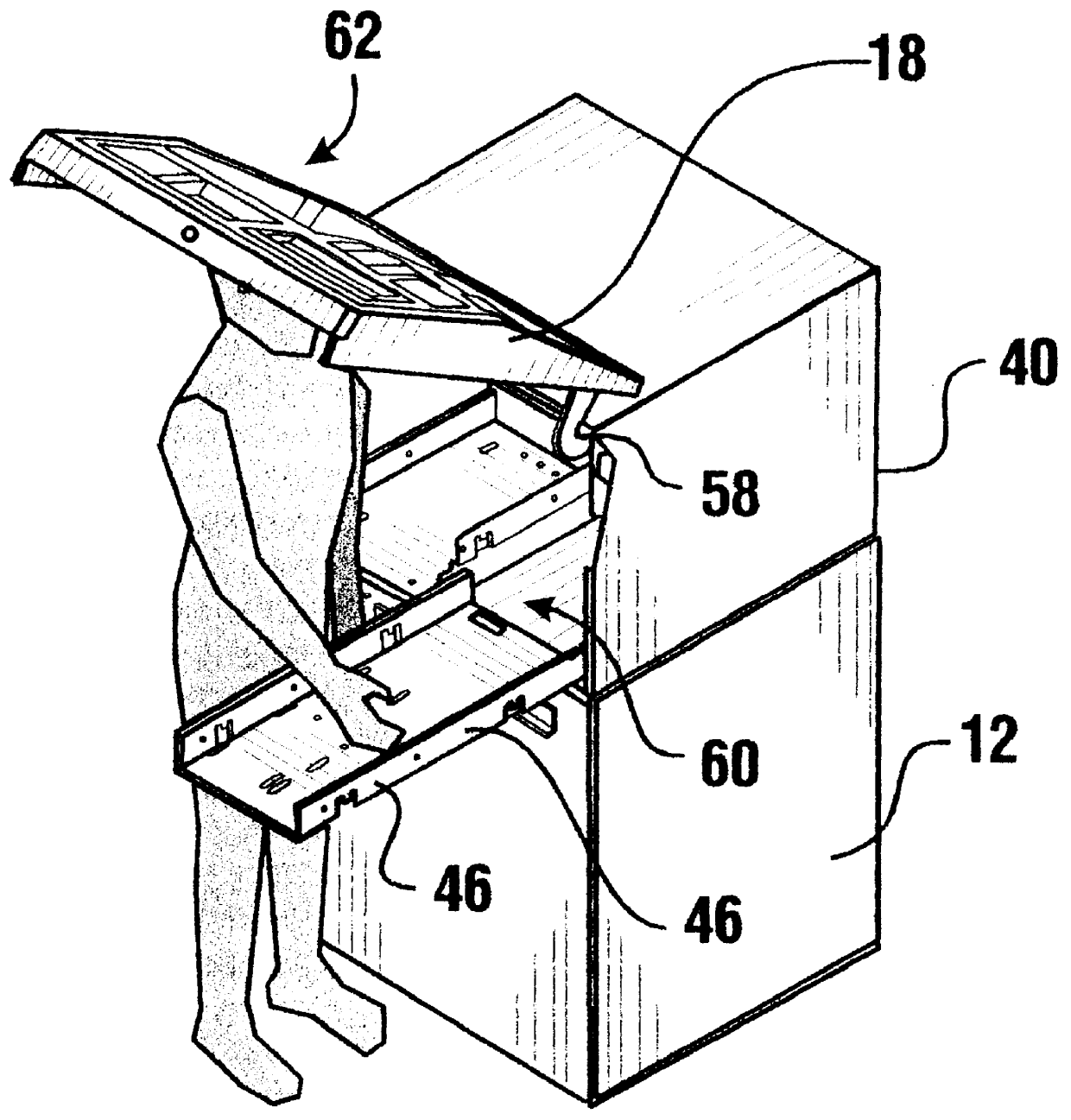

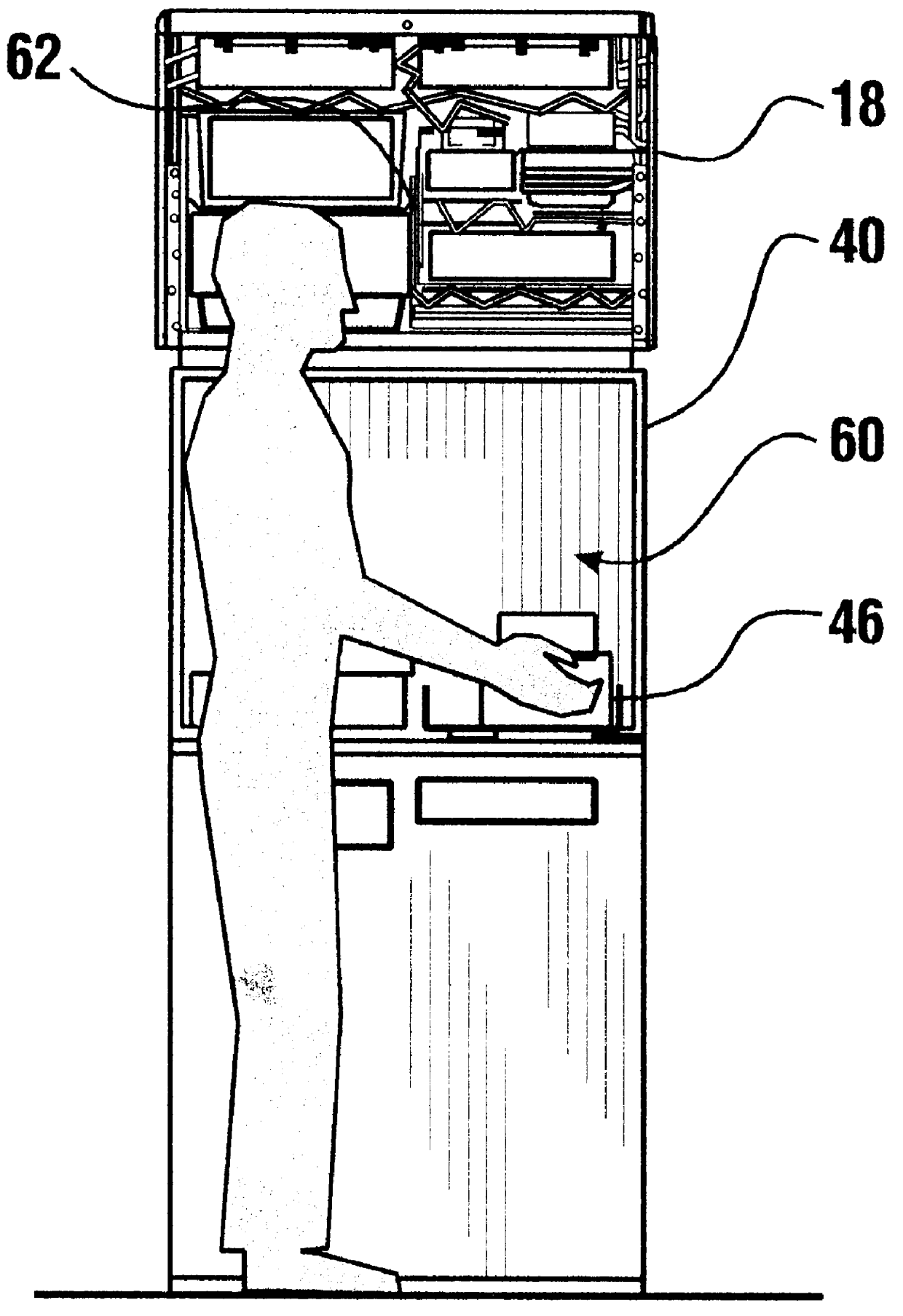

InactiveUS6010065AEasy maintenanceQuantity minimizationComplete banking machinesFinanceMechanical engineering

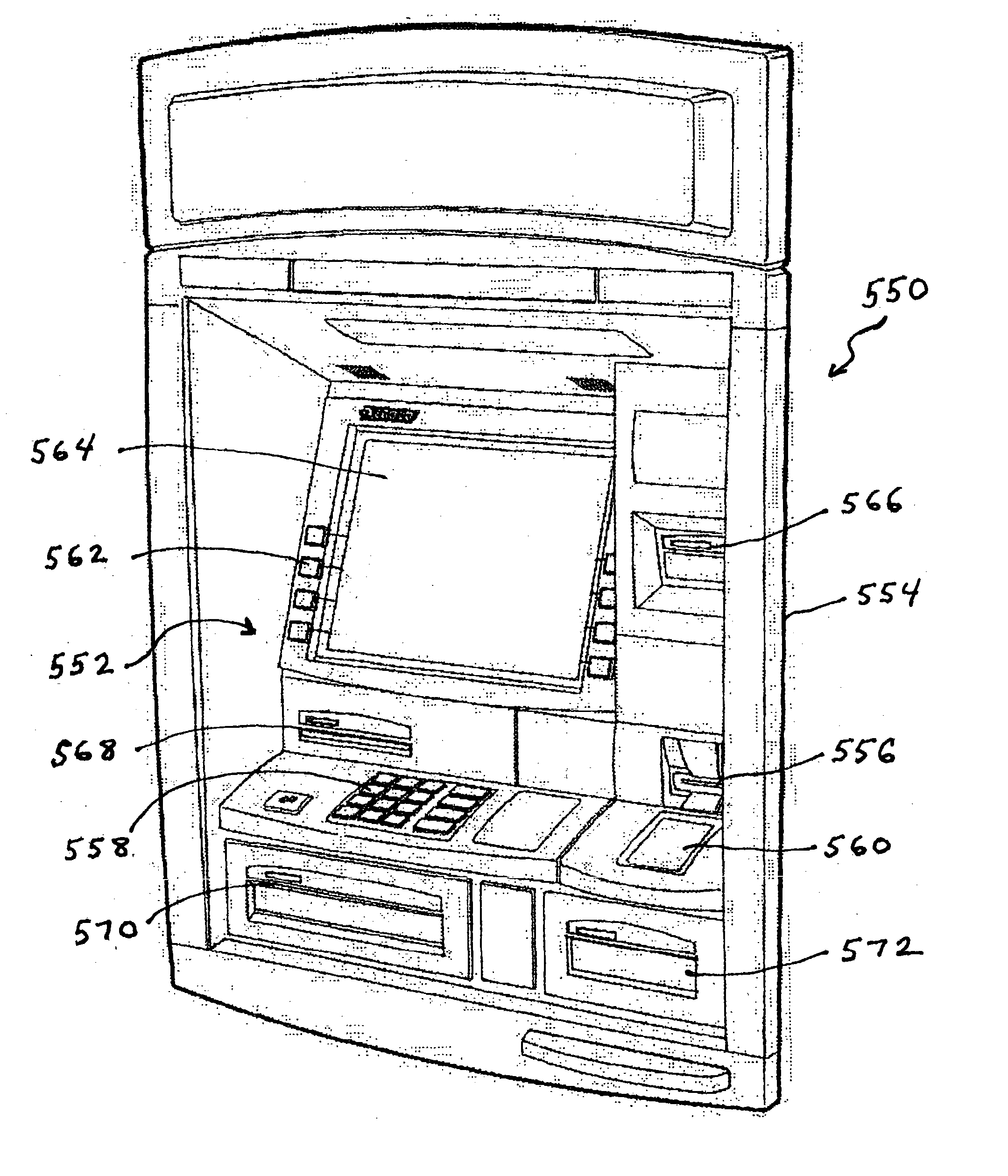

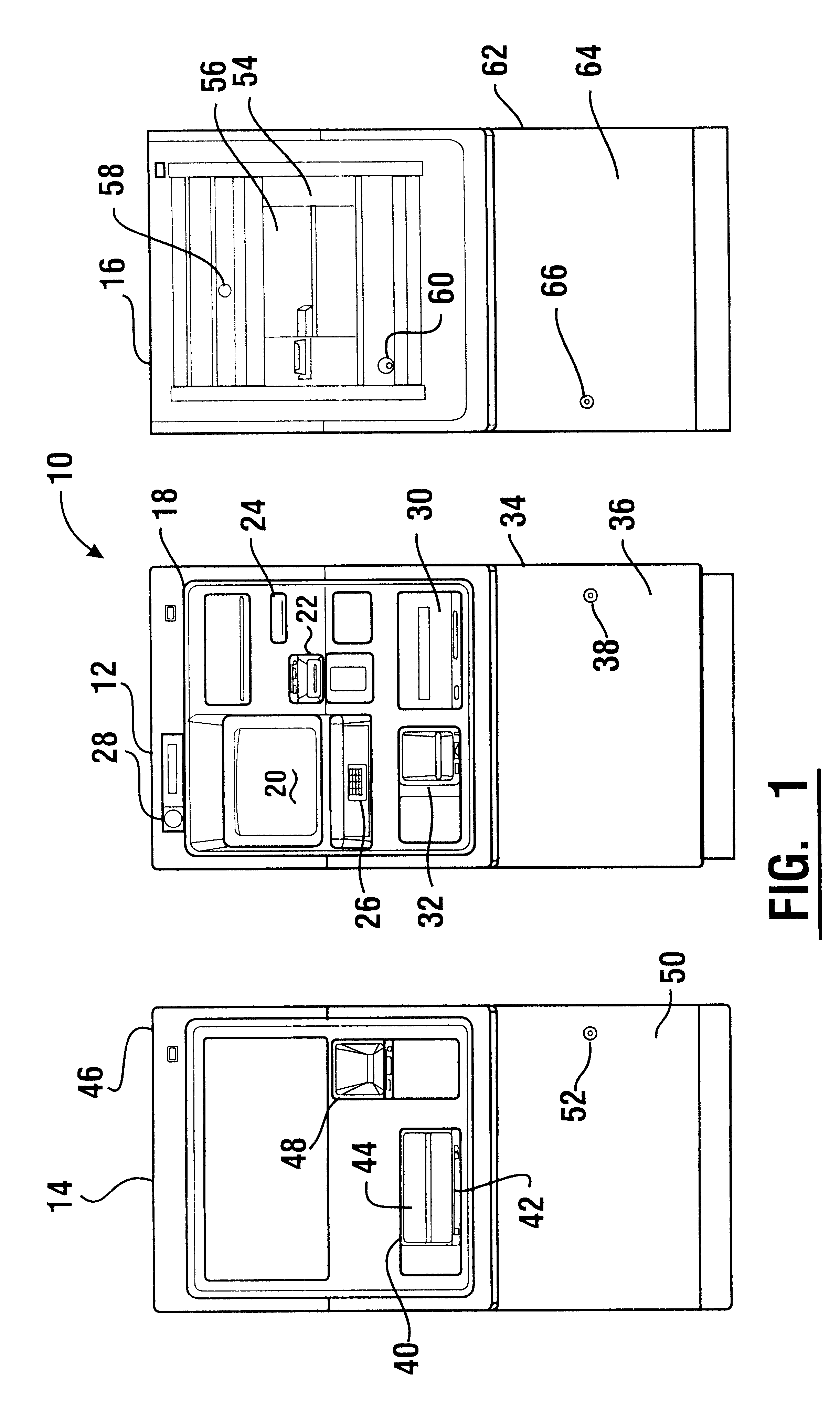

An automated banking machine (10) includes a housing (12) with a top assembly (40). Rollout trays (46) are mounted in the top assembly and have serviceable components supported thereon. Servicing is accomplished through method steps which include opening a service door (18) and separately extending and retracting the trays to render the serviceable components thereon accessible for servicing.

Owner:DIEBOLD NIXDORF

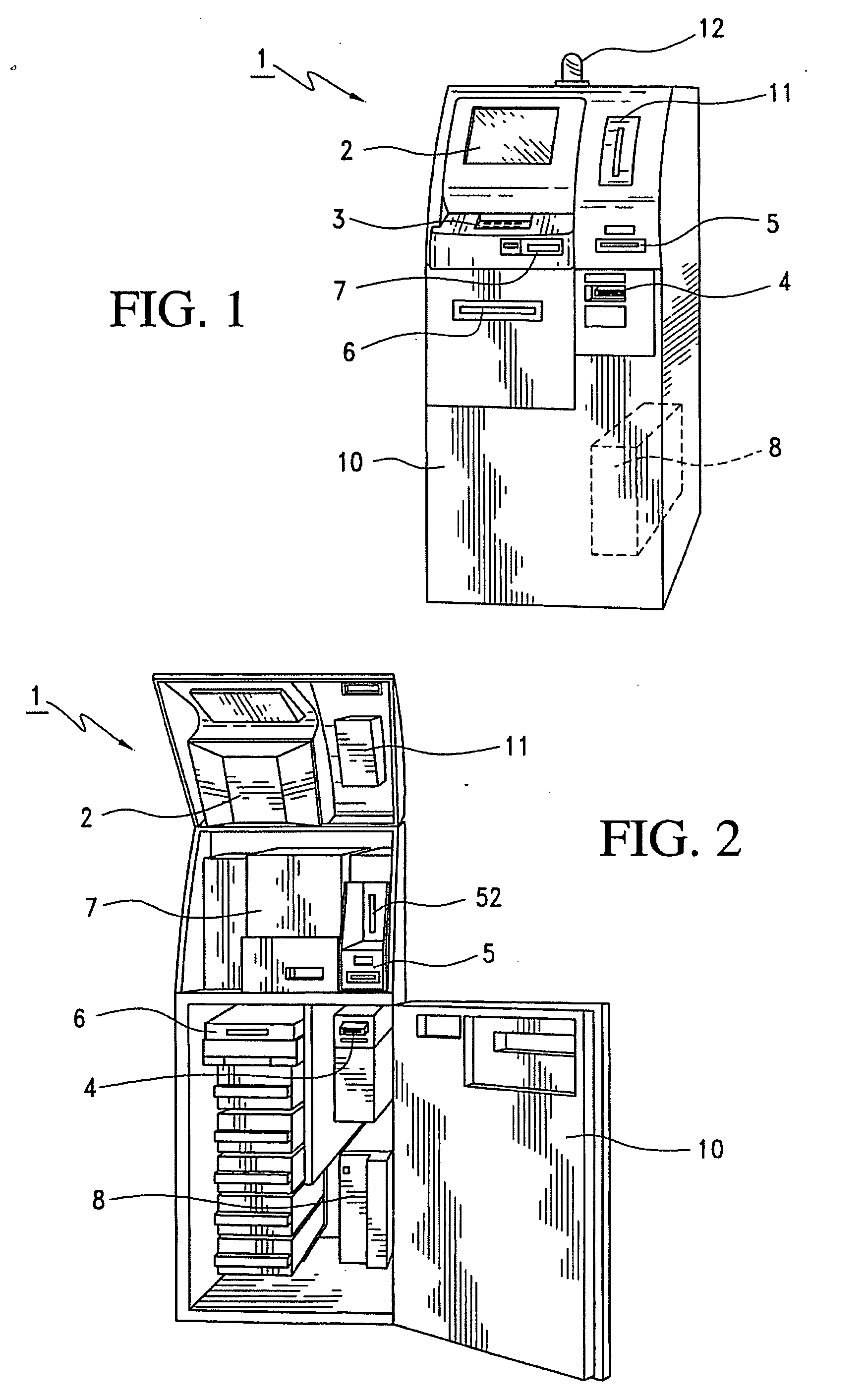

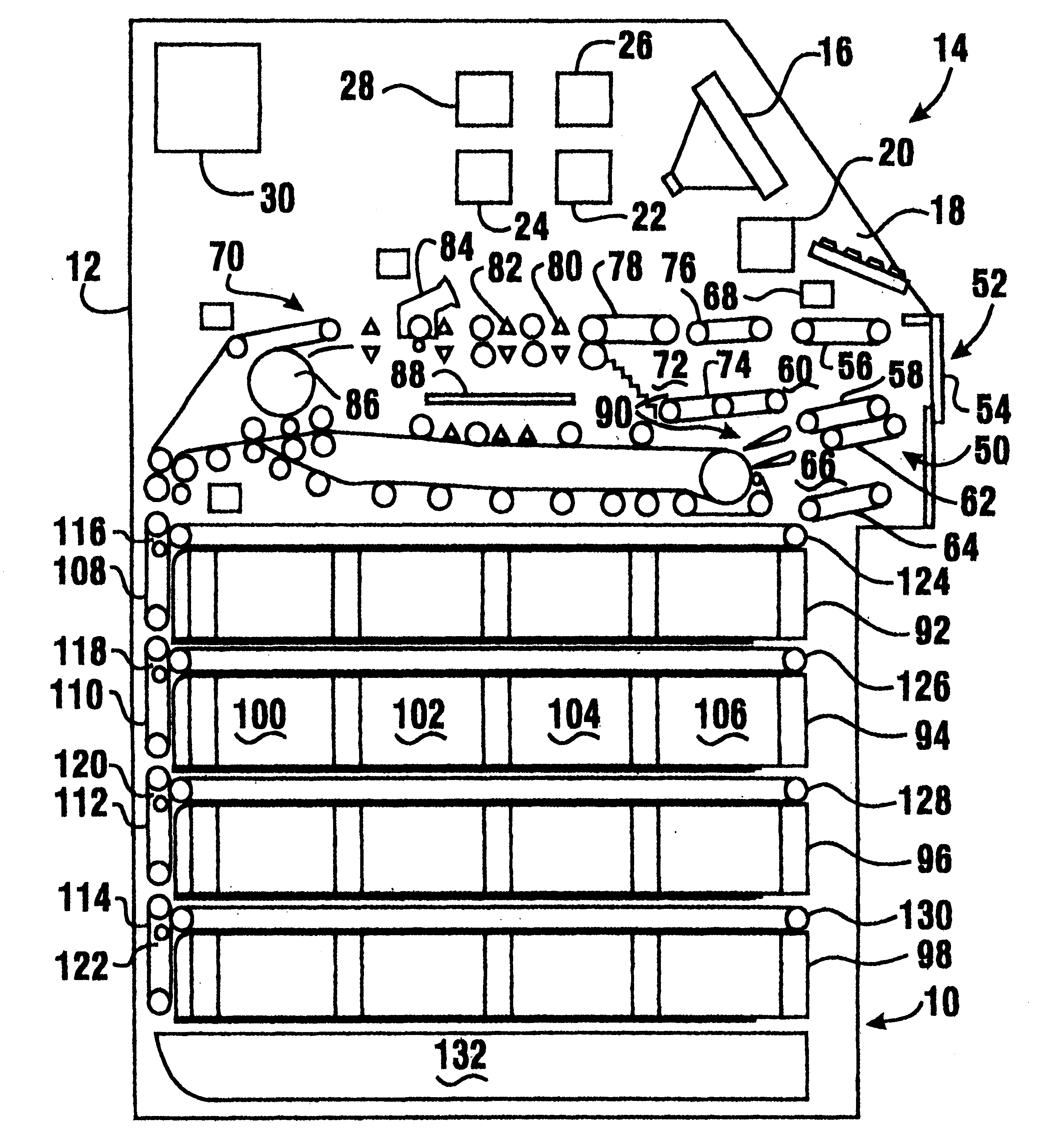

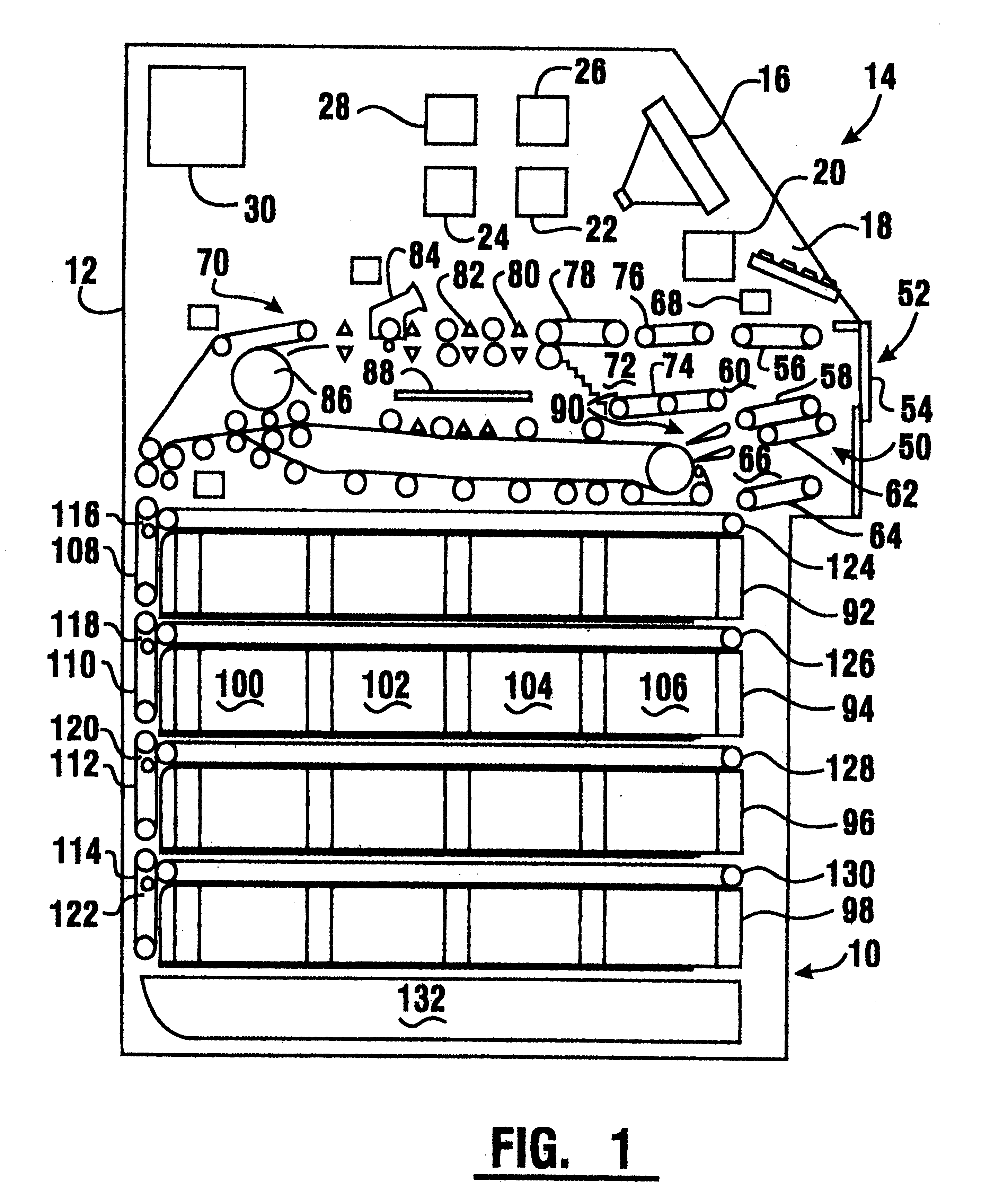

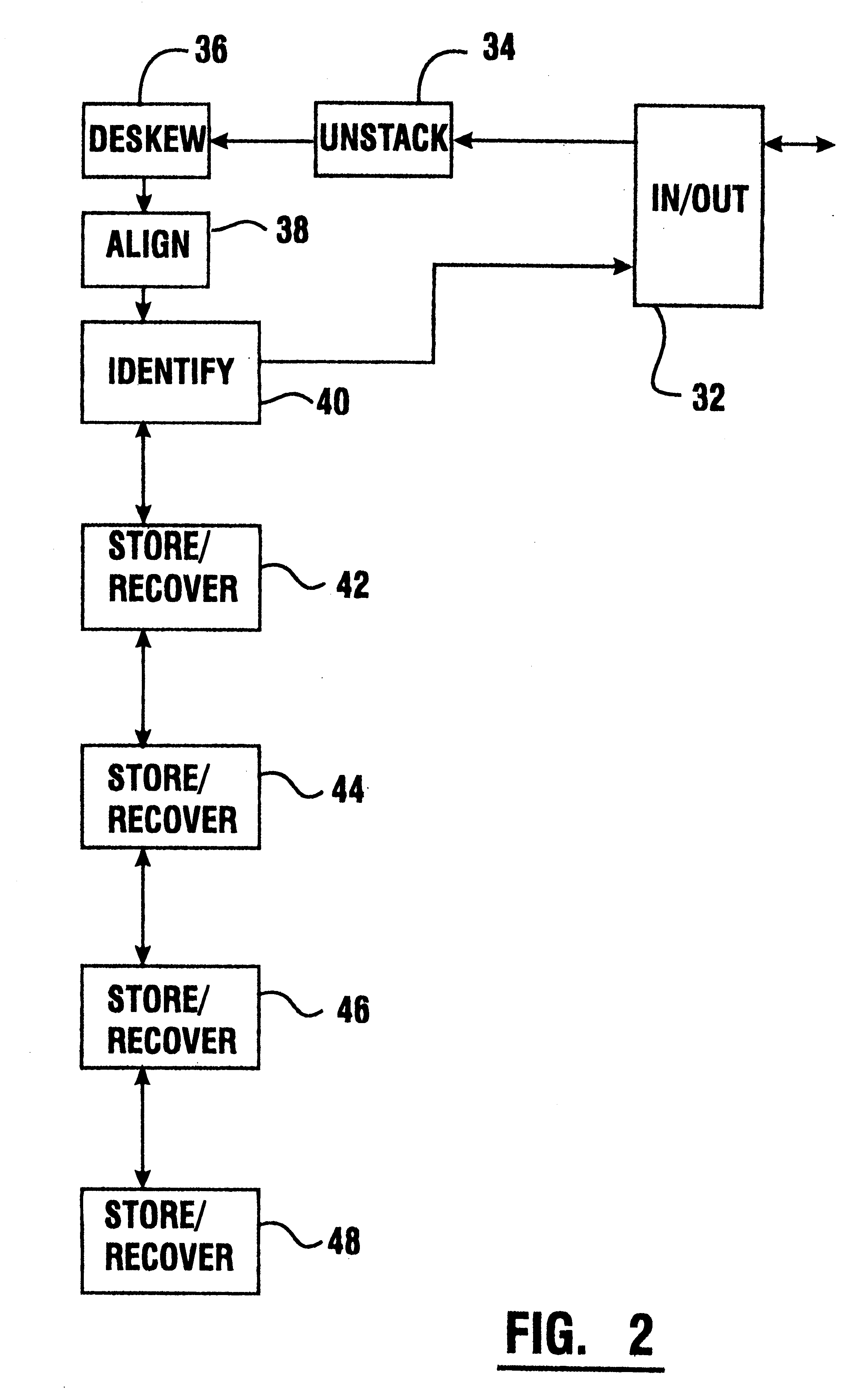

Automated banking machine with self auditing capabilities and system

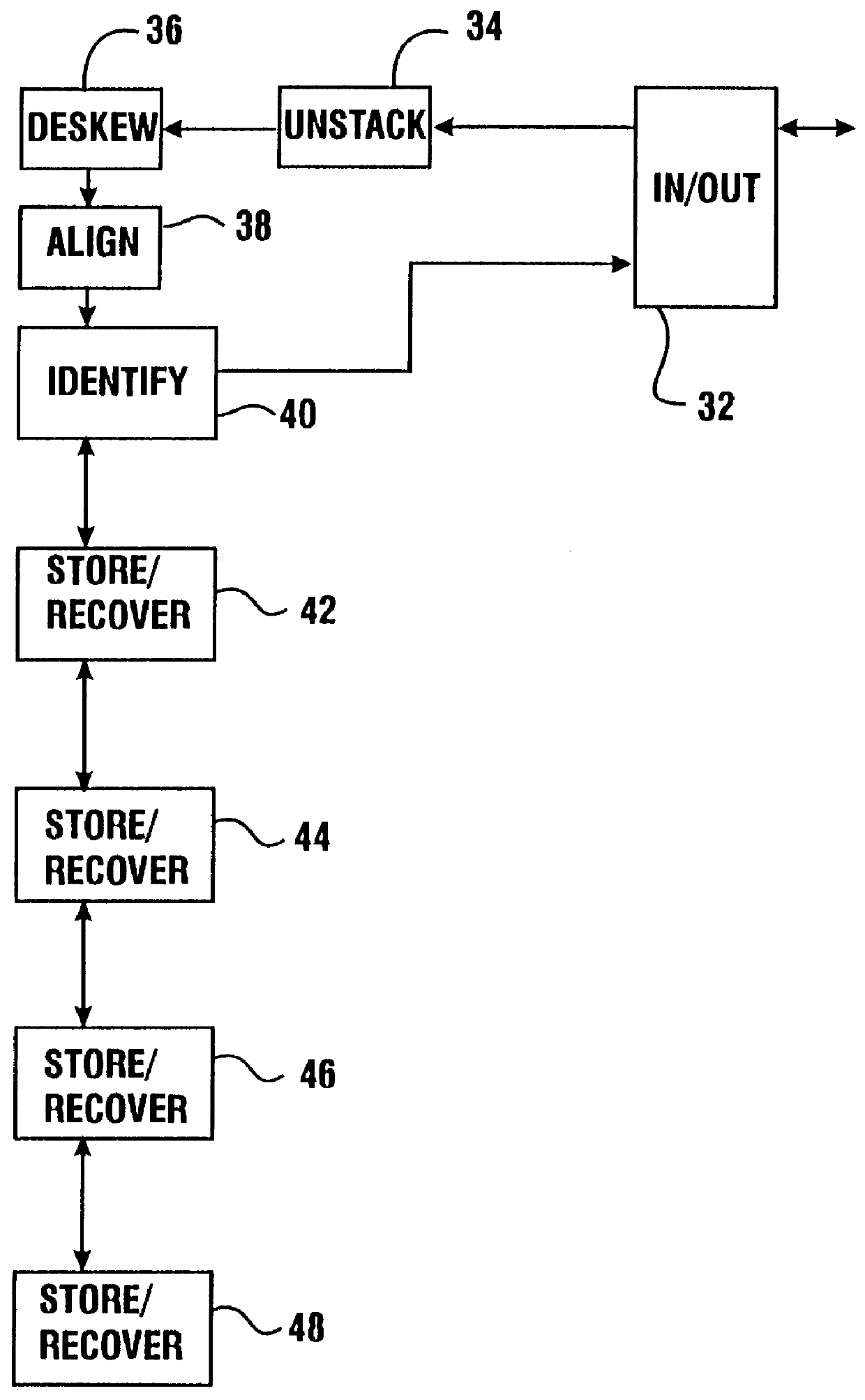

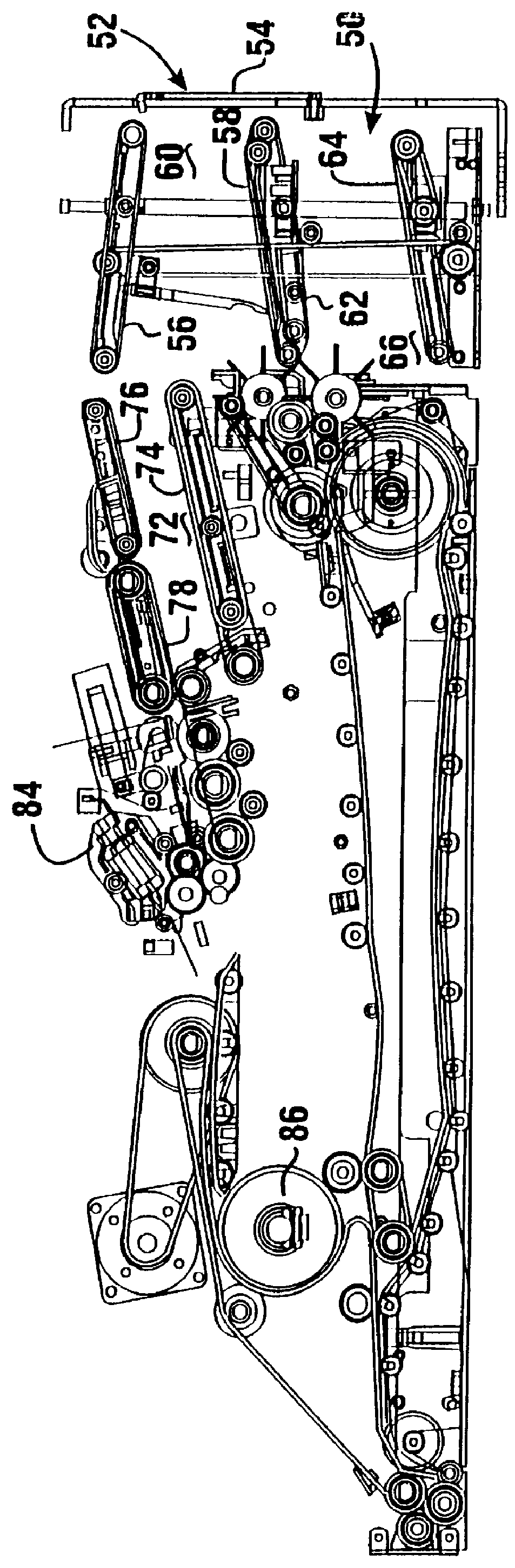

InactiveUS6109522AEasy to operateRisk minimizationPayment architectureSpecial data processing applicationsMachine selectionDocumentation

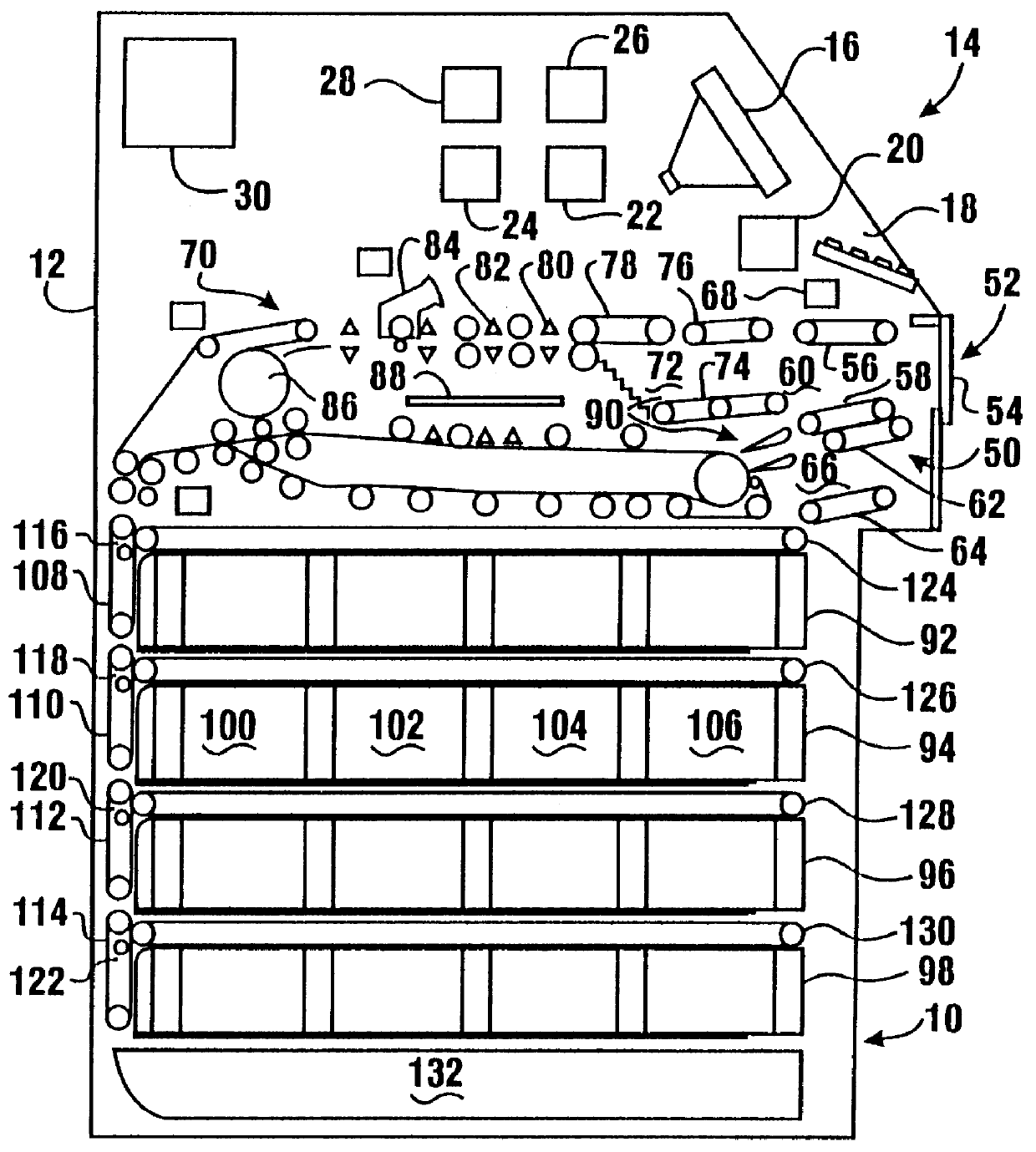

An automated banking machine (10) identifies and stores in storage areas documents such as currency bills deposited by a user. The machine selectively recovers such documents from storage areas and dispenses them. The machine includes a central transport (70) wherein documents deposited in a stack are unstacked, oriented and identified. Such documents are then routed to storage areas in canisters (92, 94, 96, 98). Documents in the storage areas are selectively picked therefrom and delivered to a user through an input / output area (50) of the machine. Each canister includes a memory (626) which holds information concerning the number and type of documents housed in the canister as well as other information concerning the hardware and software resident on the canister. The memory also includes data representative of individuals responsible for loading and transporting the canister. The machine conducts self-auditing activities to verify that the documents held in the storage areas correspond to the information stored in memory and indicate discrepancies.

Owner:DIEBOLD NIXDORF

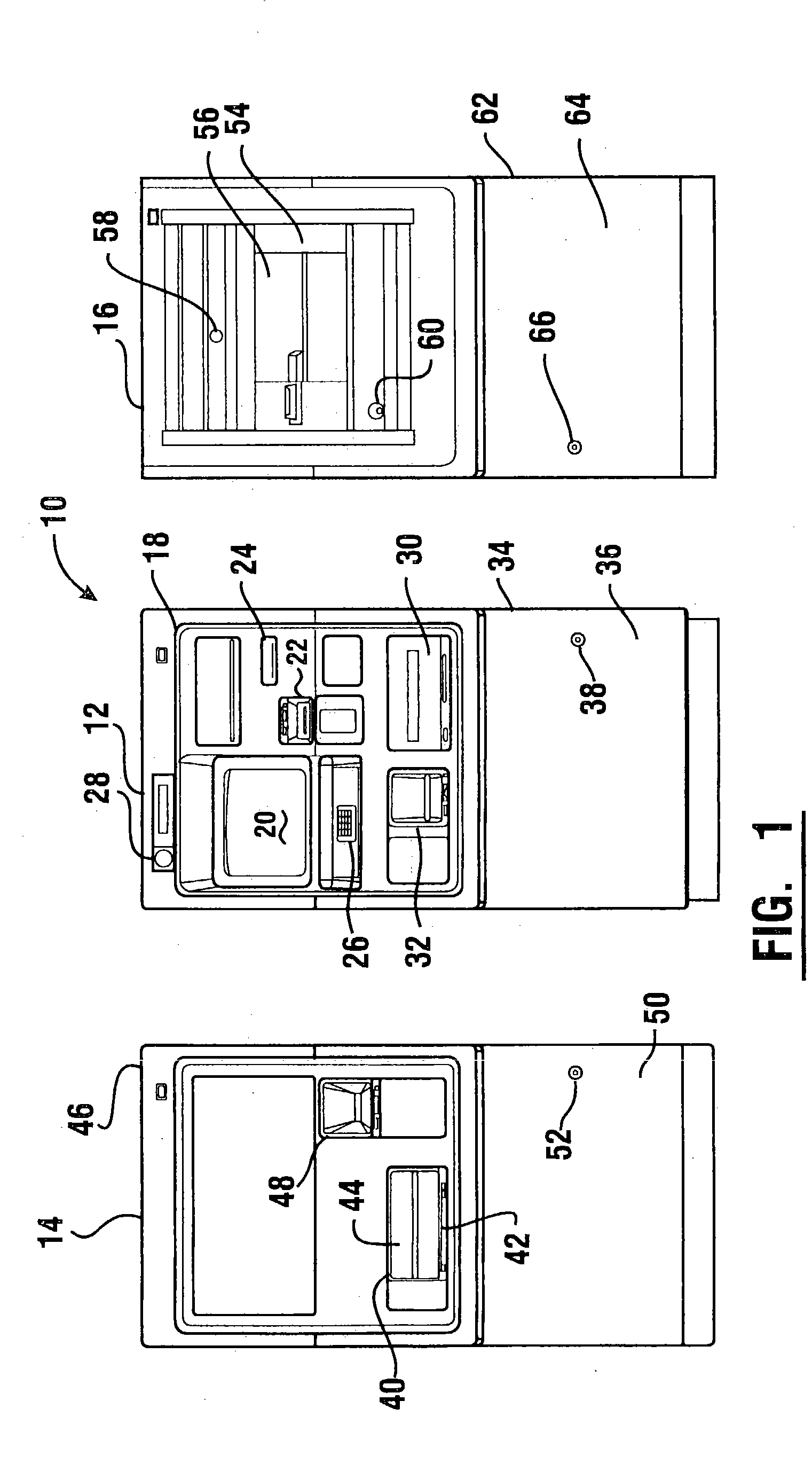

Automated merchant banking apparatus and method

InactiveUS6230928B1Good user interfaceAccurate specificationsComplete banking machinesRacksOutput deviceBiomedical engineering

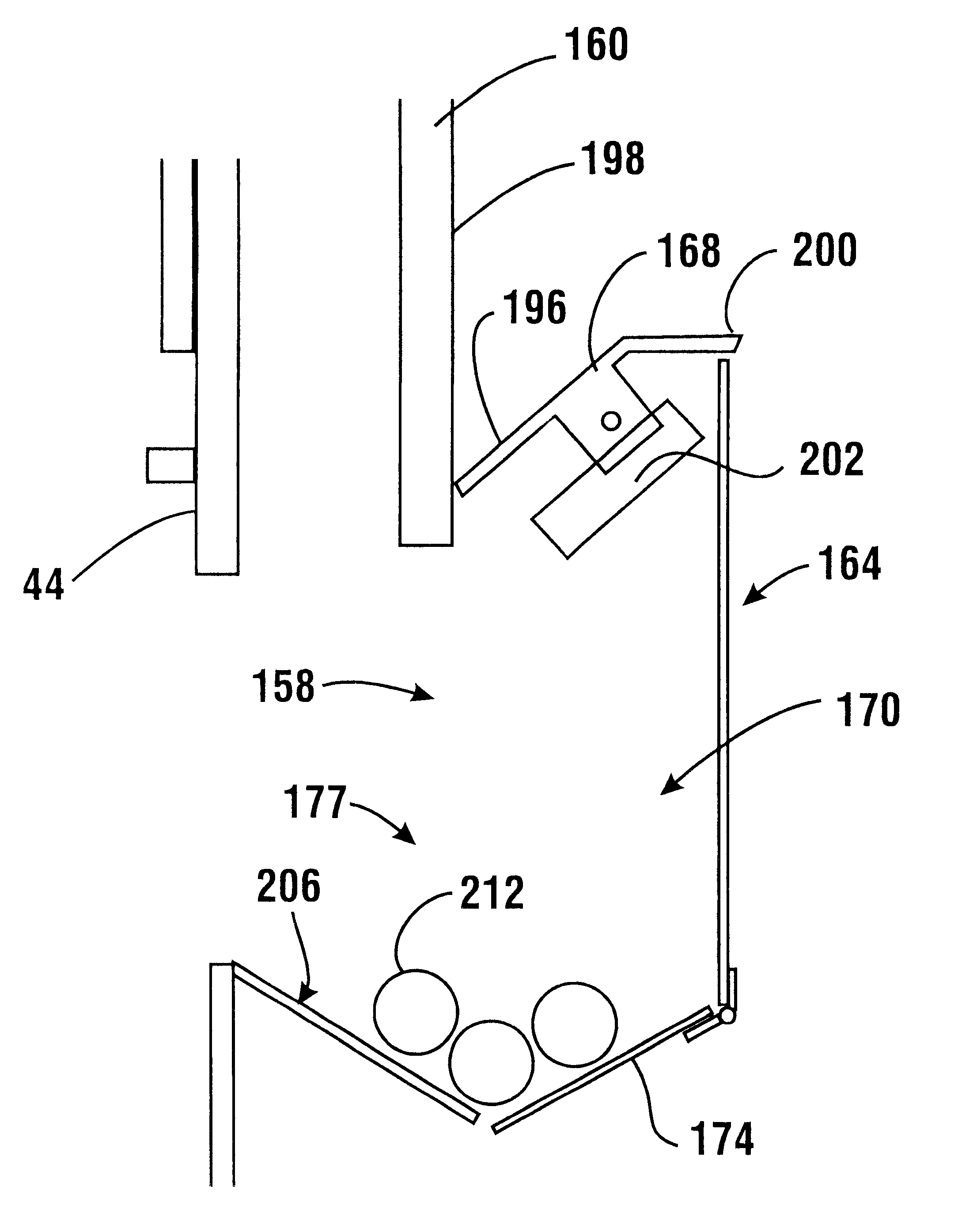

An automated merchant banking apparatus (10) is operative to carry out banking transactions commonly required by merchants. The apparatus includes a user interface (18) which includes a plurality of input and output devices. The apparatus further includes a rolled coin dispenser (40) for dispensing various denominations of rolled coin. The rolled coin dispenser includes a coin roll presenter and retraction unit (42) which is operative to retract coin rolls which have been dispensed into holding areas (177) into a storage area (176) in the machine.

Owner:DIEBOLD NIXDORF

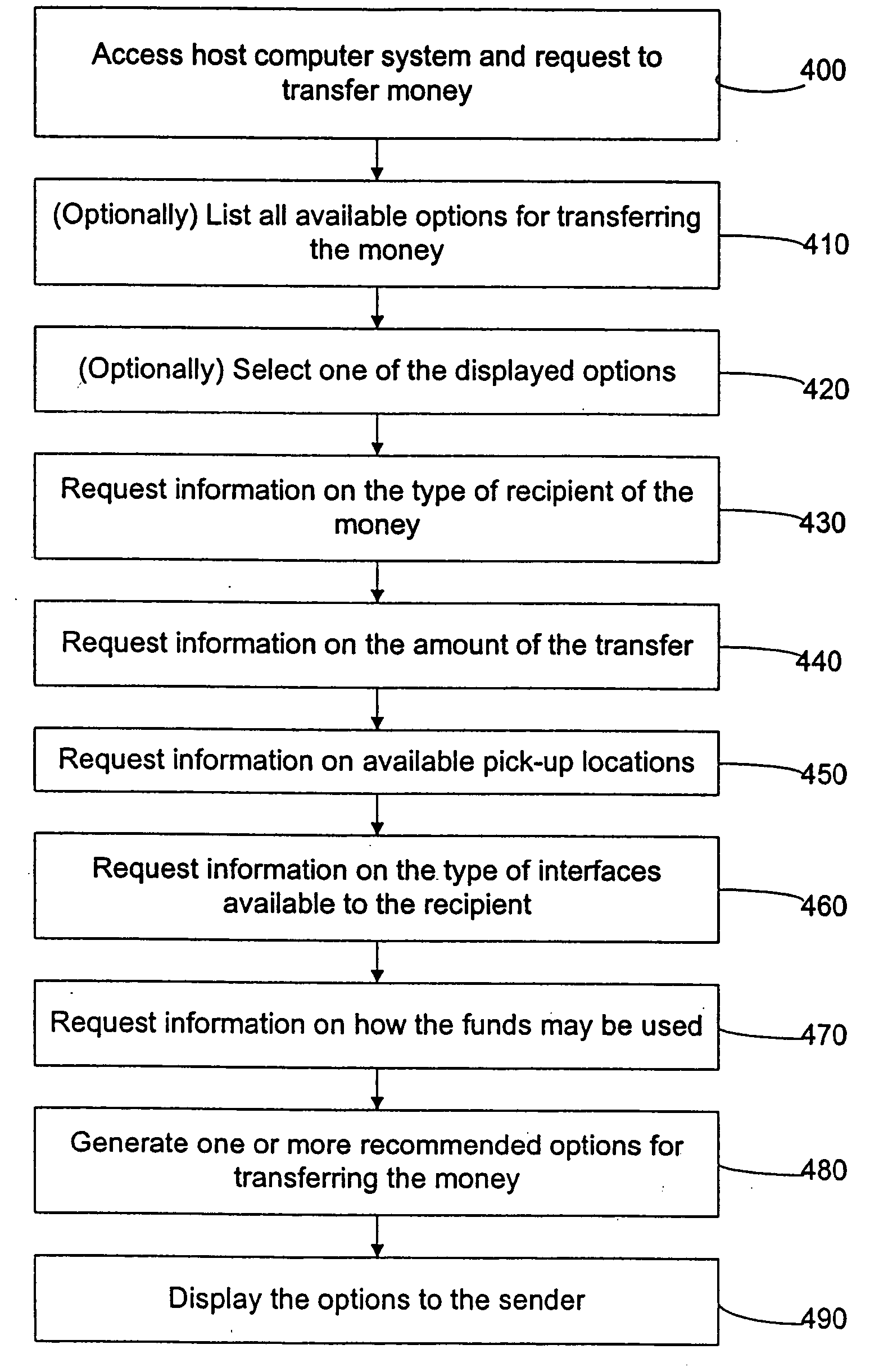

System and method for transferring money from one country to a stored value account in a different country

InactiveUS20050167481A1Efficient receptionNeed can be stimulatedComplete banking machinesFinanceRemote computerComputer science

One method involves payment of money to a recipient traveling to one or more foreign countries by entering into a remote computer money transfer information from a sender. The money transfer information comprises recipient identification information, at least one country where the money is to be received, and a payment amount in an originating currency. The money transfer information is transmitted to a host computer system. When ready to receive payment in the designated country, recipient identification information along with a request to withdraw a portion of a possible payment amount is entered into a payout computer. The recipient identification information and the request to withdraw is transmitted to a host computer system, and the requested withdrawal is provided to the recipient in the local currency.

Owner:THE WESTERN UNION CO

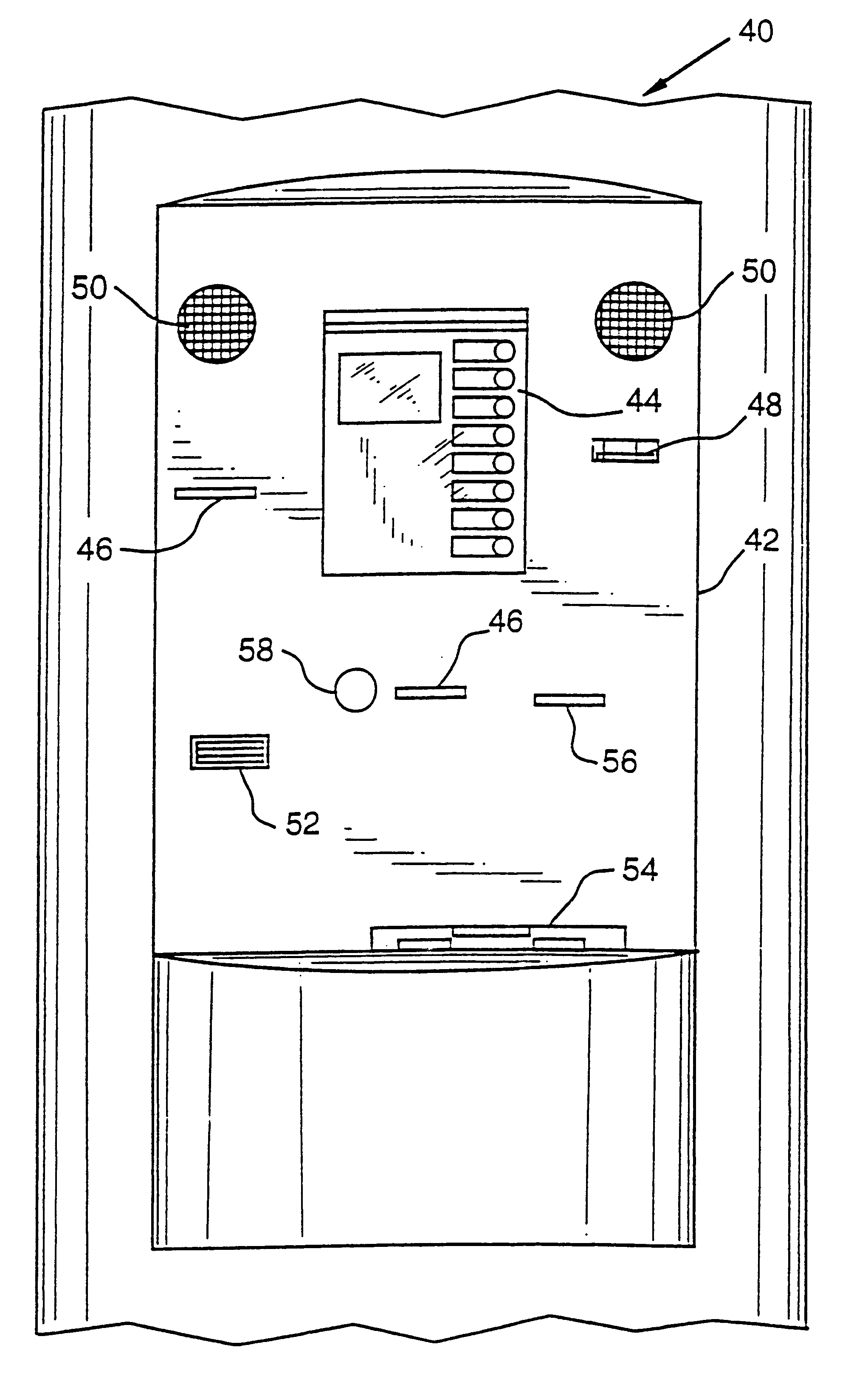

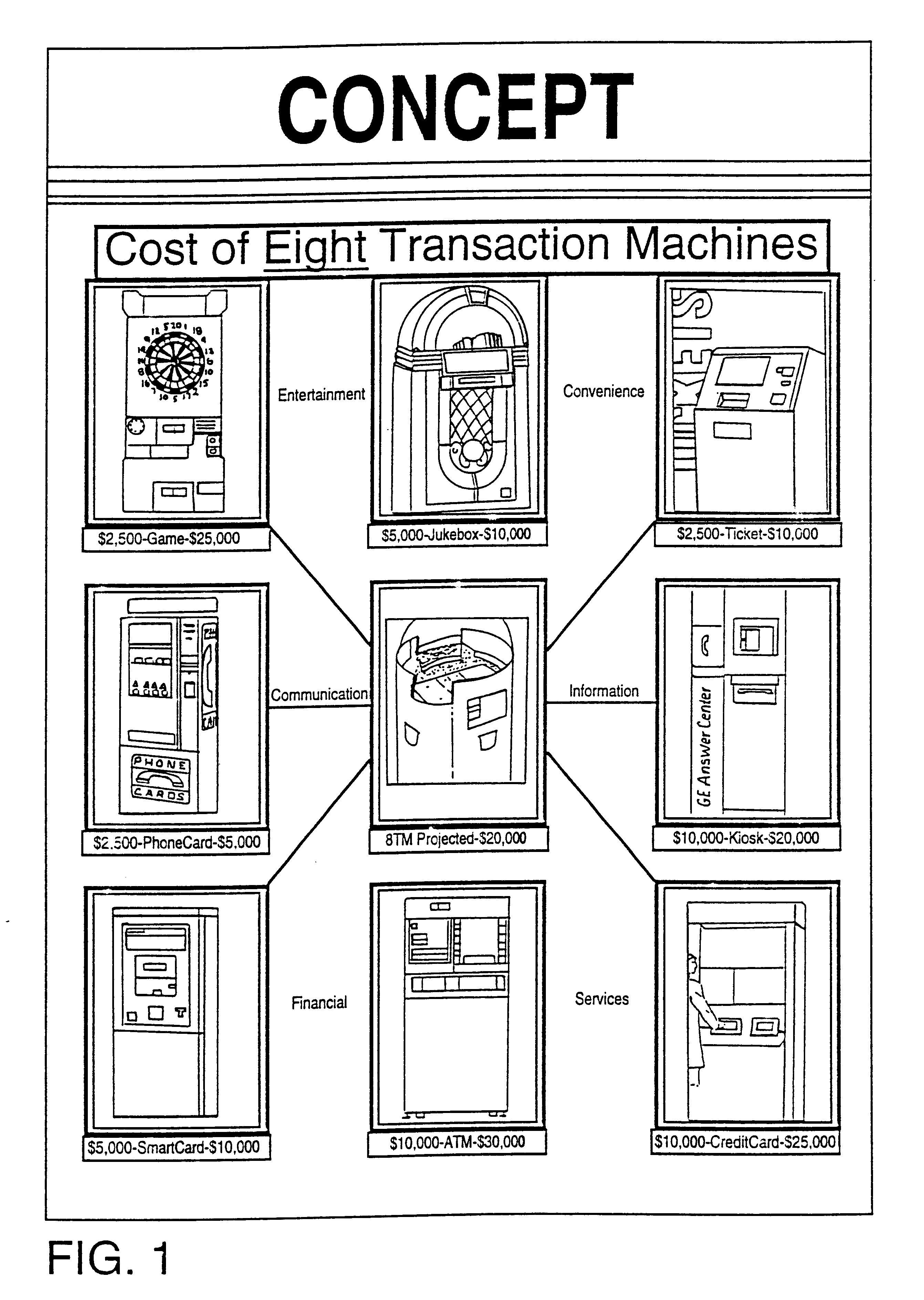

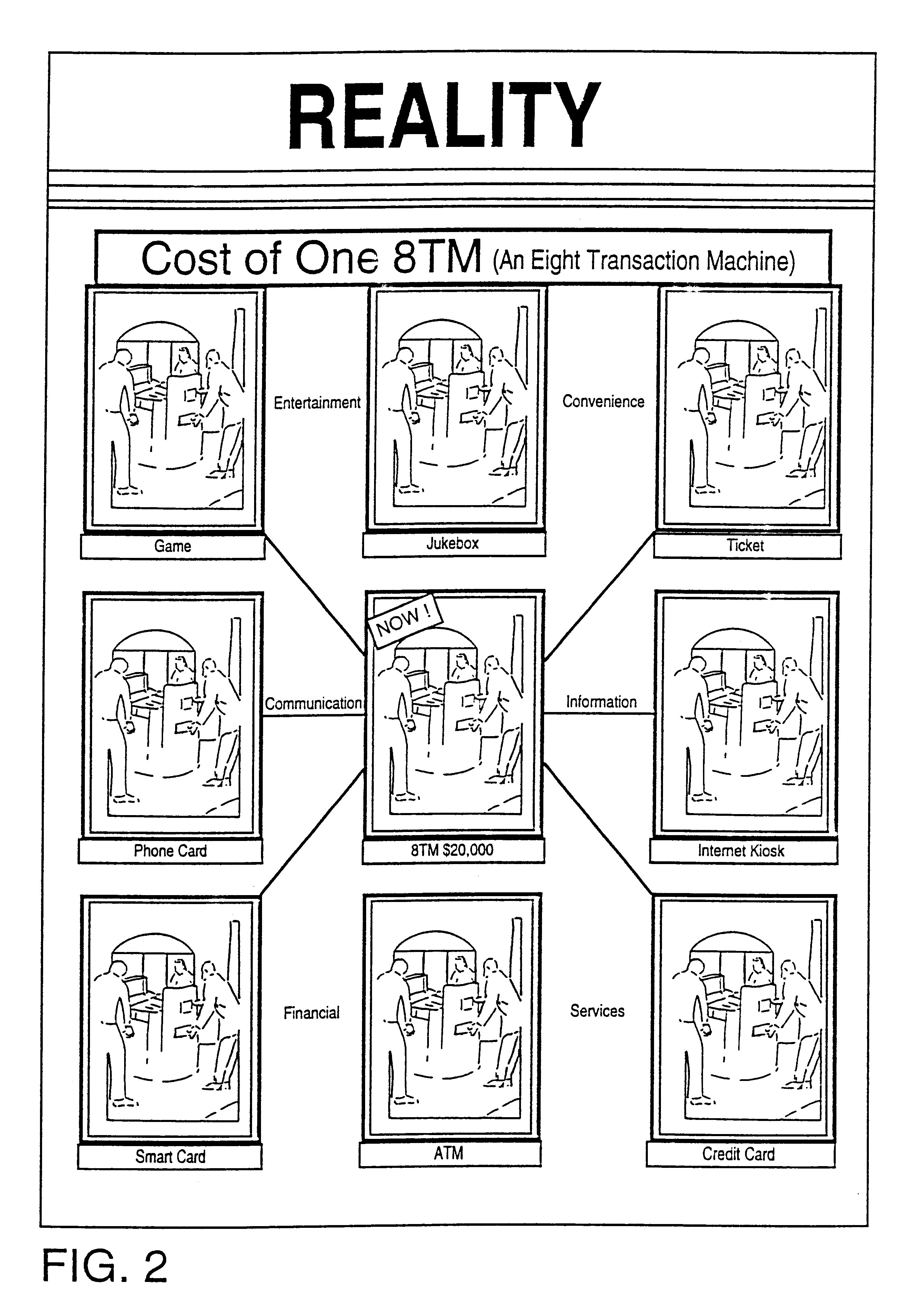

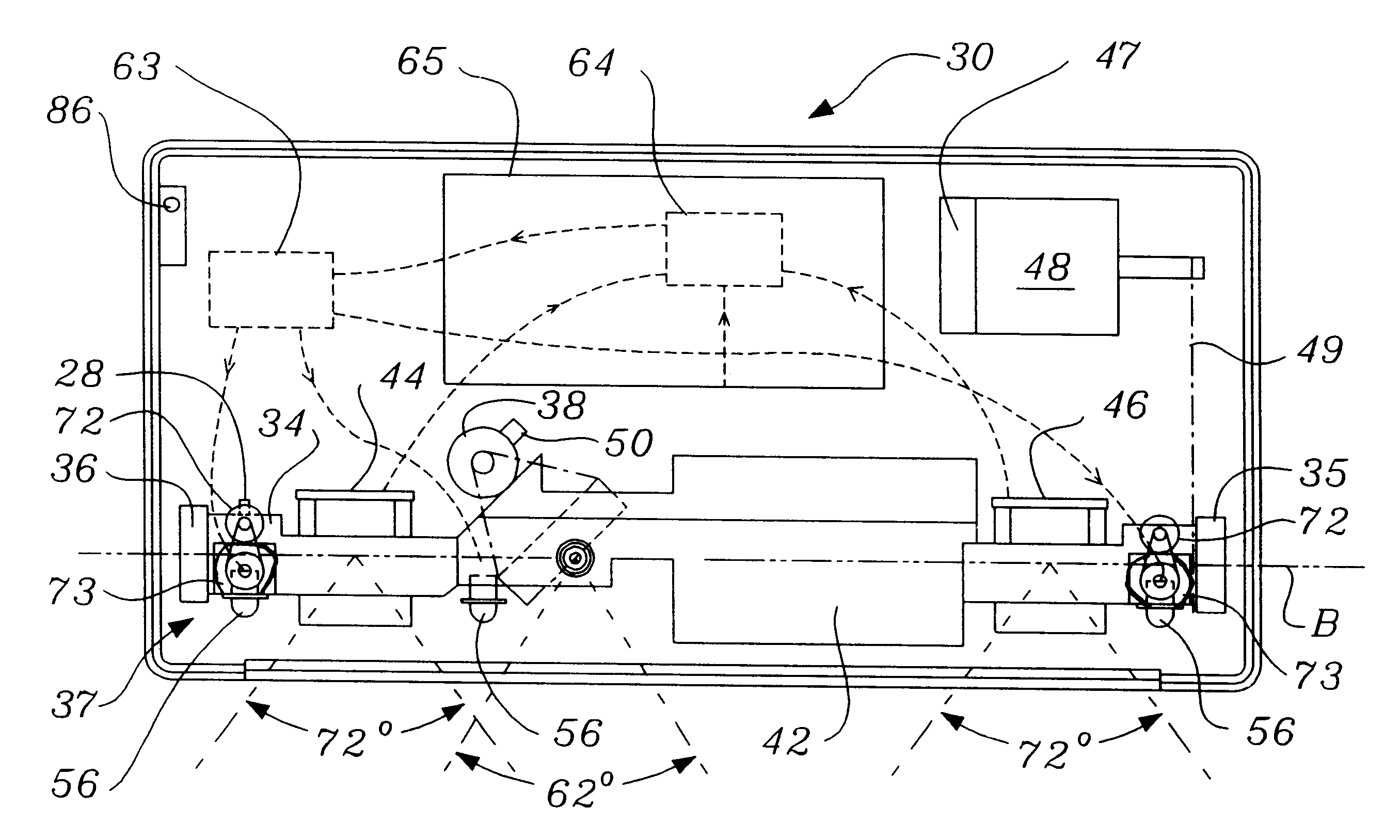

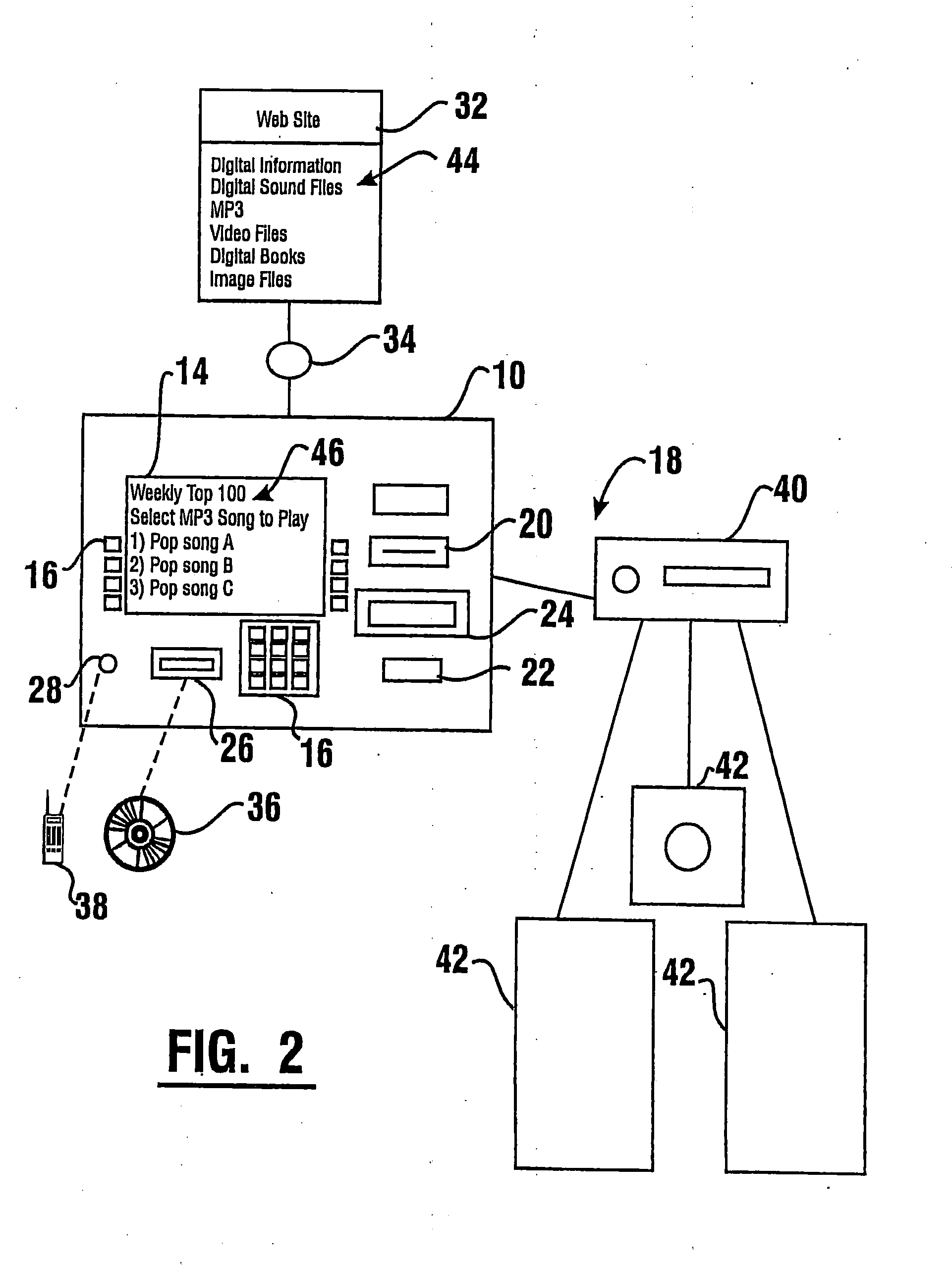

Automated transaction machine

An automated retail terminal in which a plurality of goods and / or services are provided in an integrated system (40). The integrated system (40) generally avoids duplicating hardware or functions in the course of delivering the goods or services offered, so for example in a combination ATM and Internet kiosk the same credit card or smart card reader (48) is used for both the ATM and the Internet kiosk functions, the same control screen (42, 44) activates the ATM functions and the Internet functions, and etc.

Owner:TRANSACTION HLDG L L C

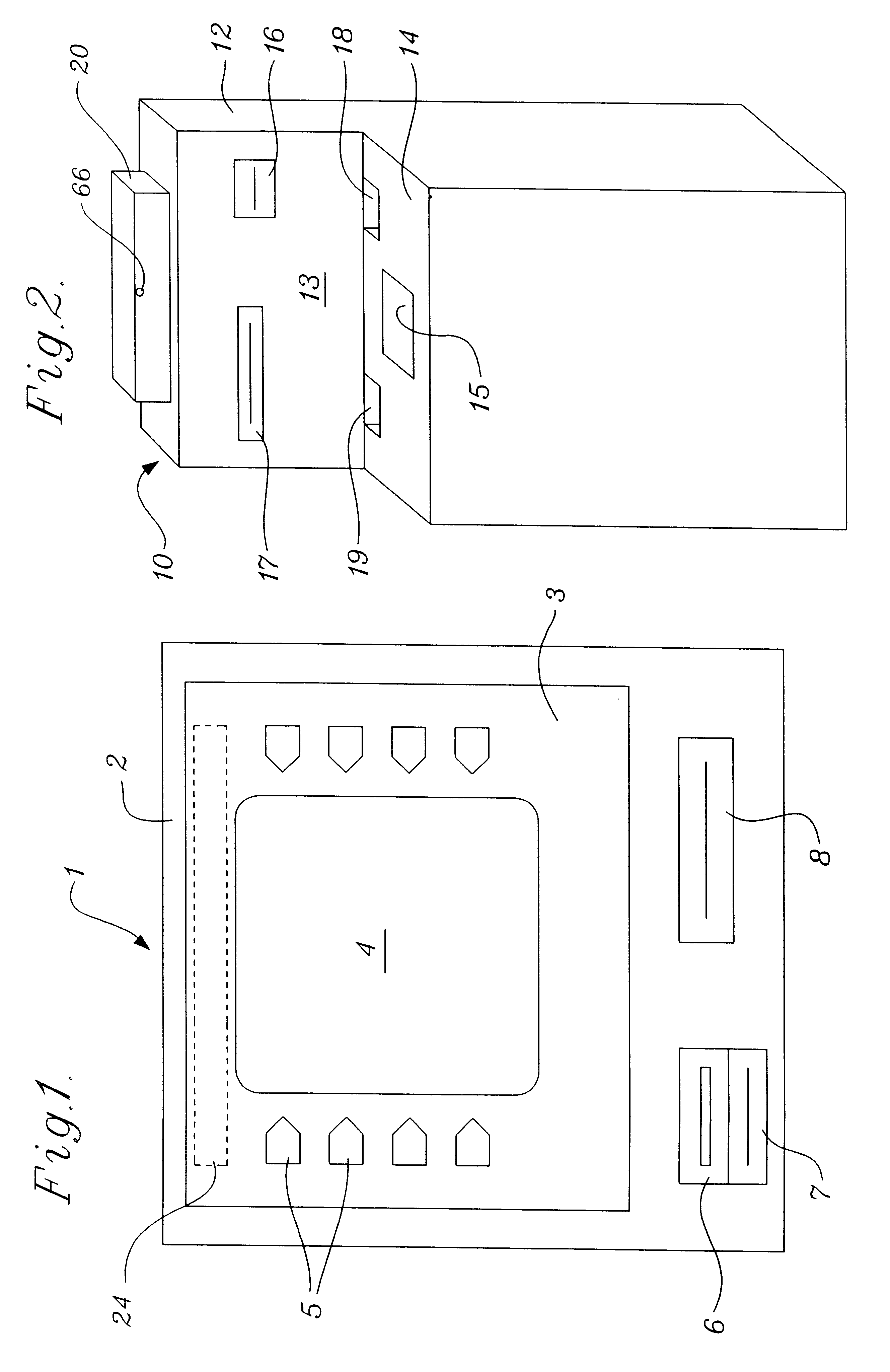

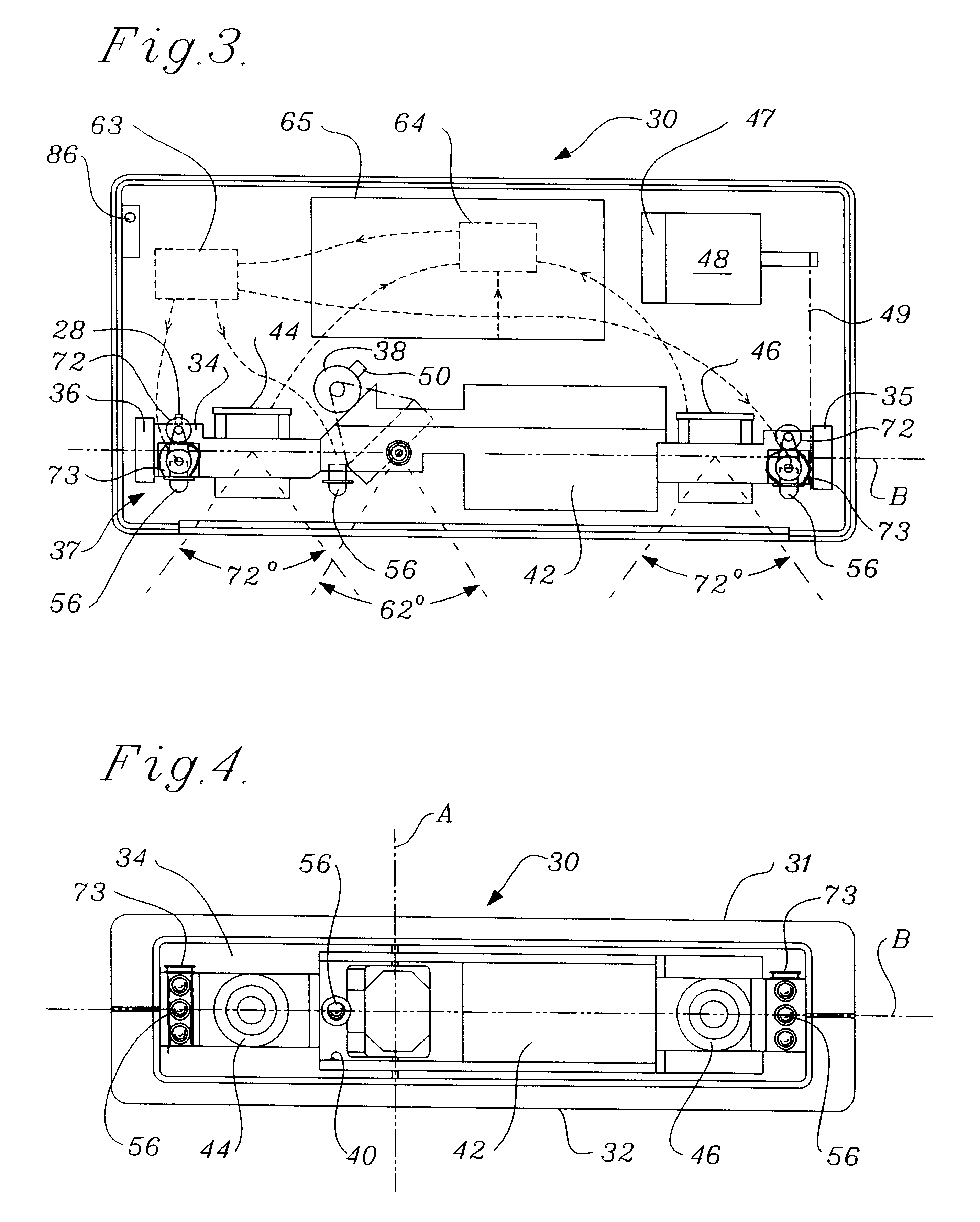

Compact imaging device incorporating rotatably mounted cameras

A compact image steering and focusing device has a generally rectangular frame containing at least one illuminator and at least one and preferably two cameras and a pan / tilt mirror on a tilting frame. There is a tilt axis through the frame. A tilt motor is attached to the frame to turn the frame about the tilt axis. Another camera is positioned in optical alignment with the pan / tilt mirror. The device can fit behind the cover plate of an automated teller machine. Images from the cameras on the titling frame are used to focus the other camera on one eye of the automated teller machine user to identify the user by iris analysis and comparison to an iris image or iris code on file.

Owner:SENSAR

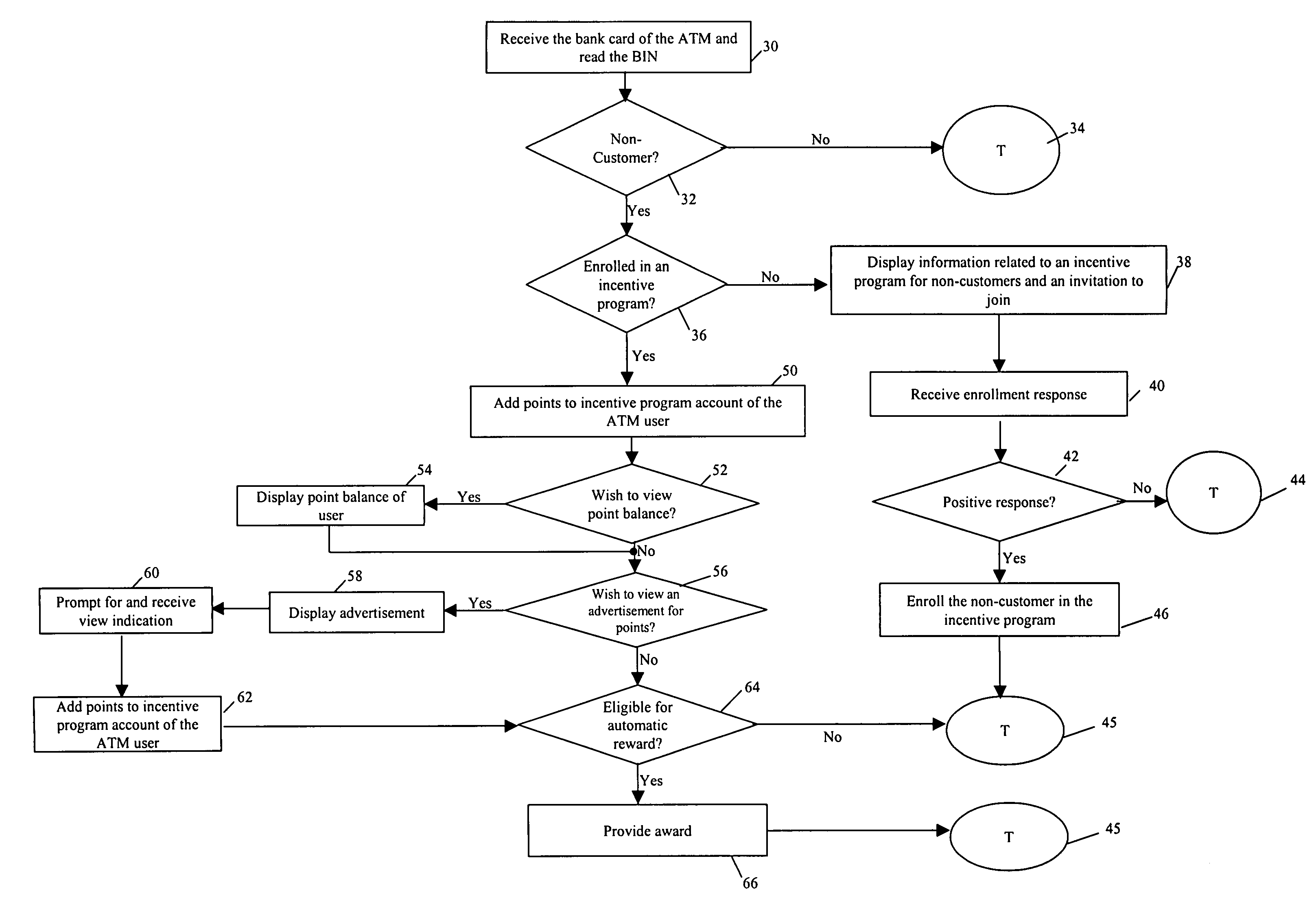

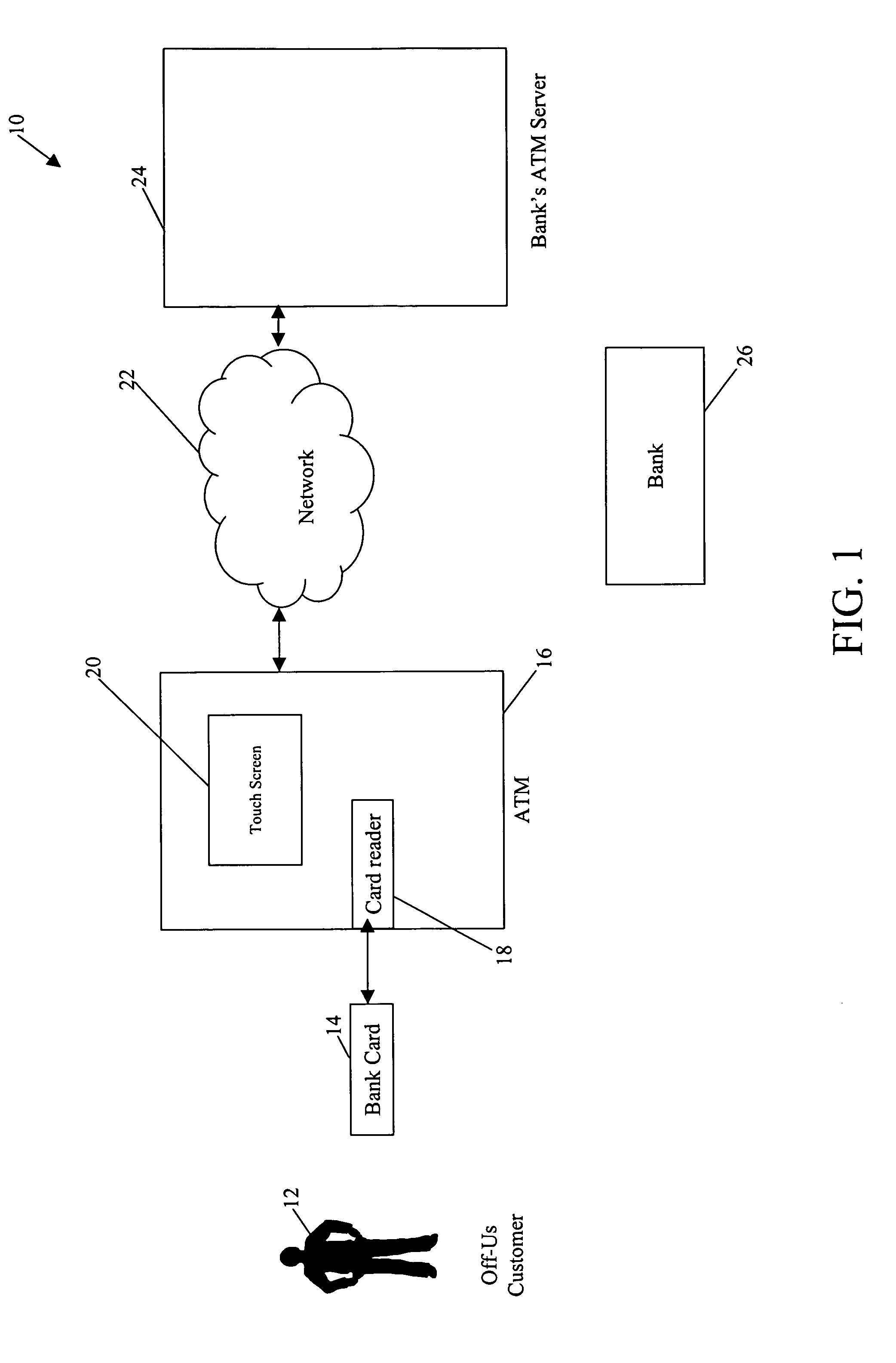

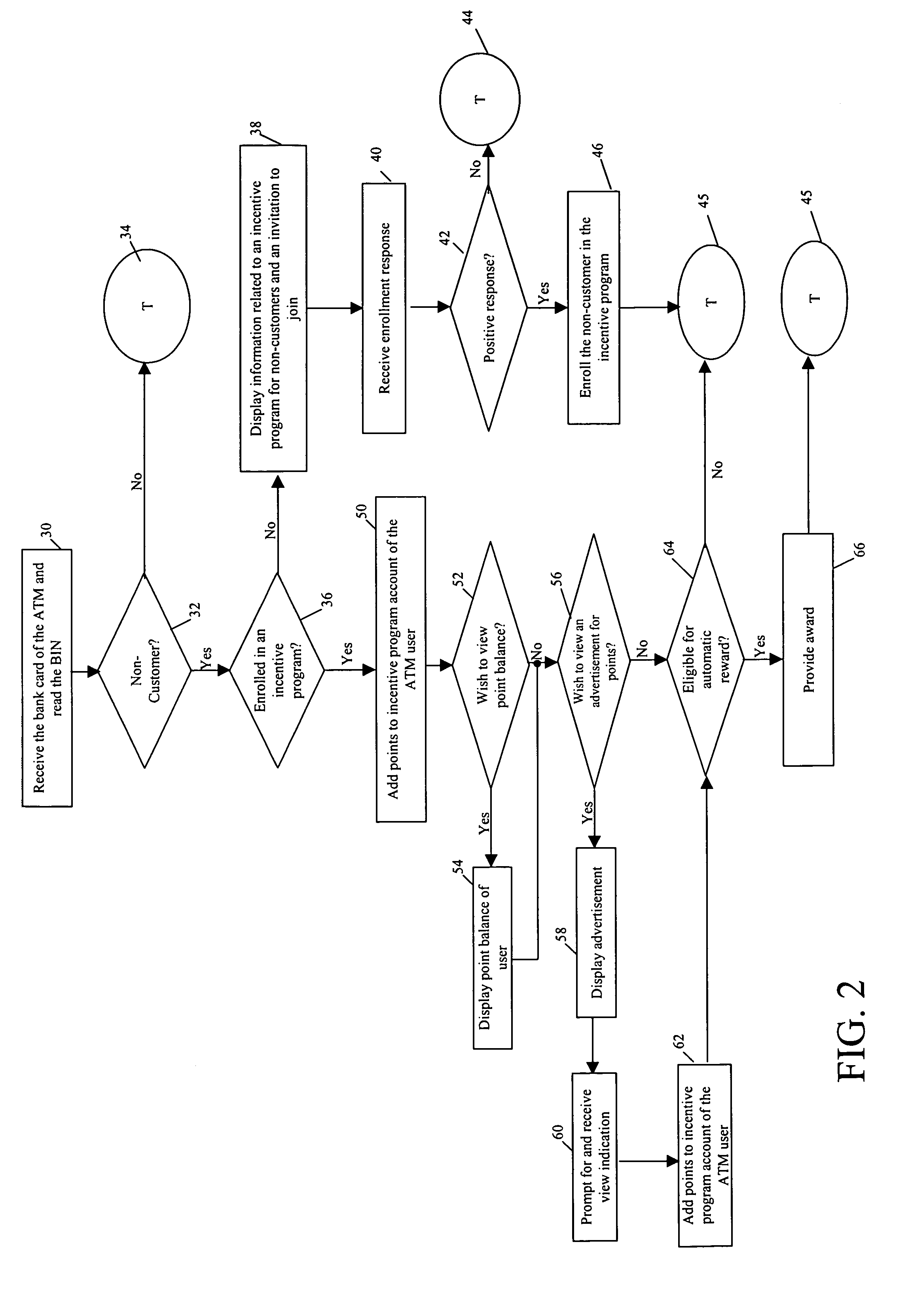

Method and system for providing an incentive to use an automated teller machine (ATM)

The present invention provides methods and systems for promoting banking services to non-customers at an automated teller machine (ATM) through an incentive system. Non-customers who enroll in the incentive system are awarded points based on ATM use, viewing of advertisements at an ATM, and other factors. When a pre-determined number of points is accumulated by the non-customer, the non-customer is provided with an award (e.g., a convenience fee for use of the ATM is forgiven). In addition, use of networked ATMs by the non-customer is tracked in order to provide tailored awards and advertisements.

Owner:CITICORP CREDIT SERVICES INC (USA)

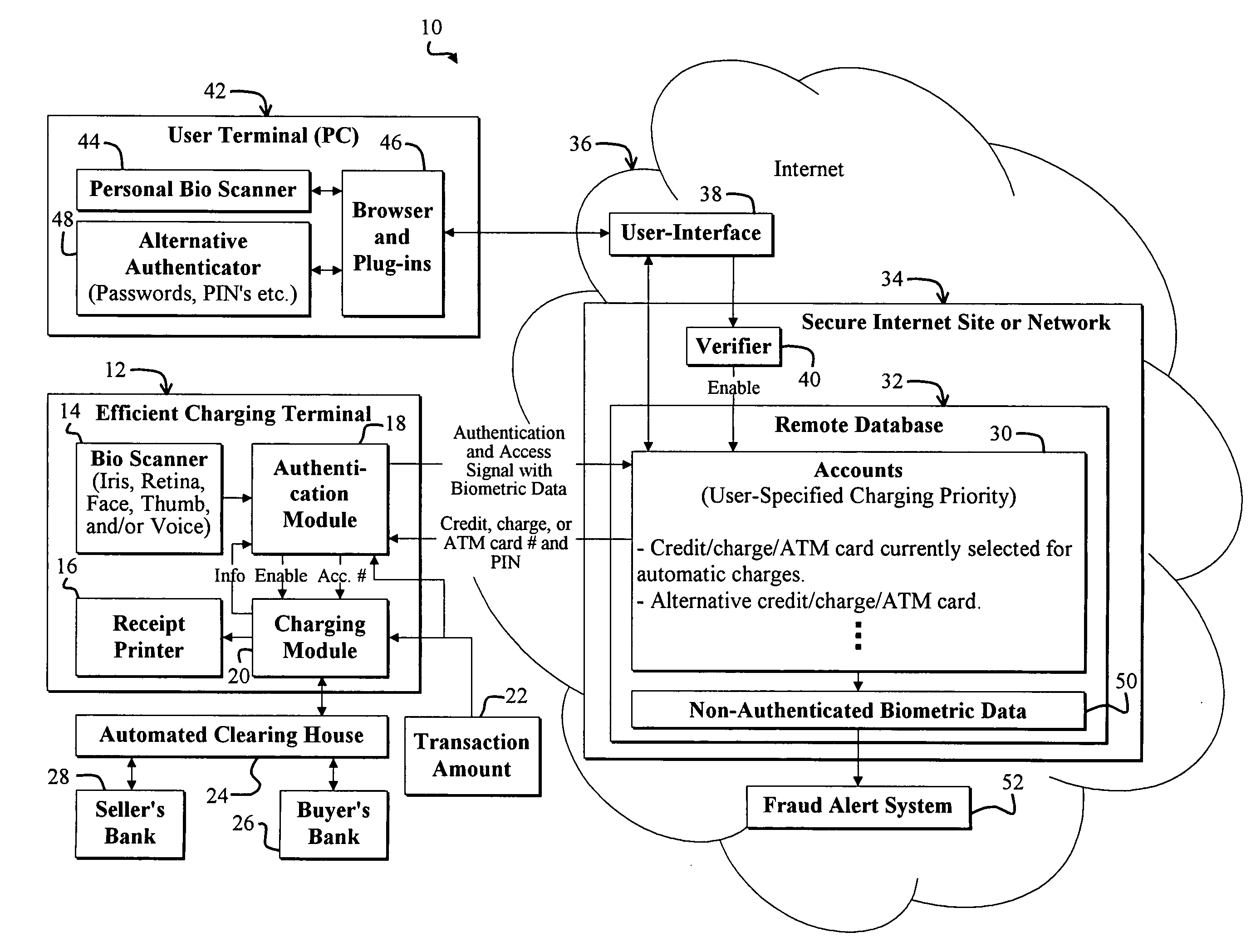

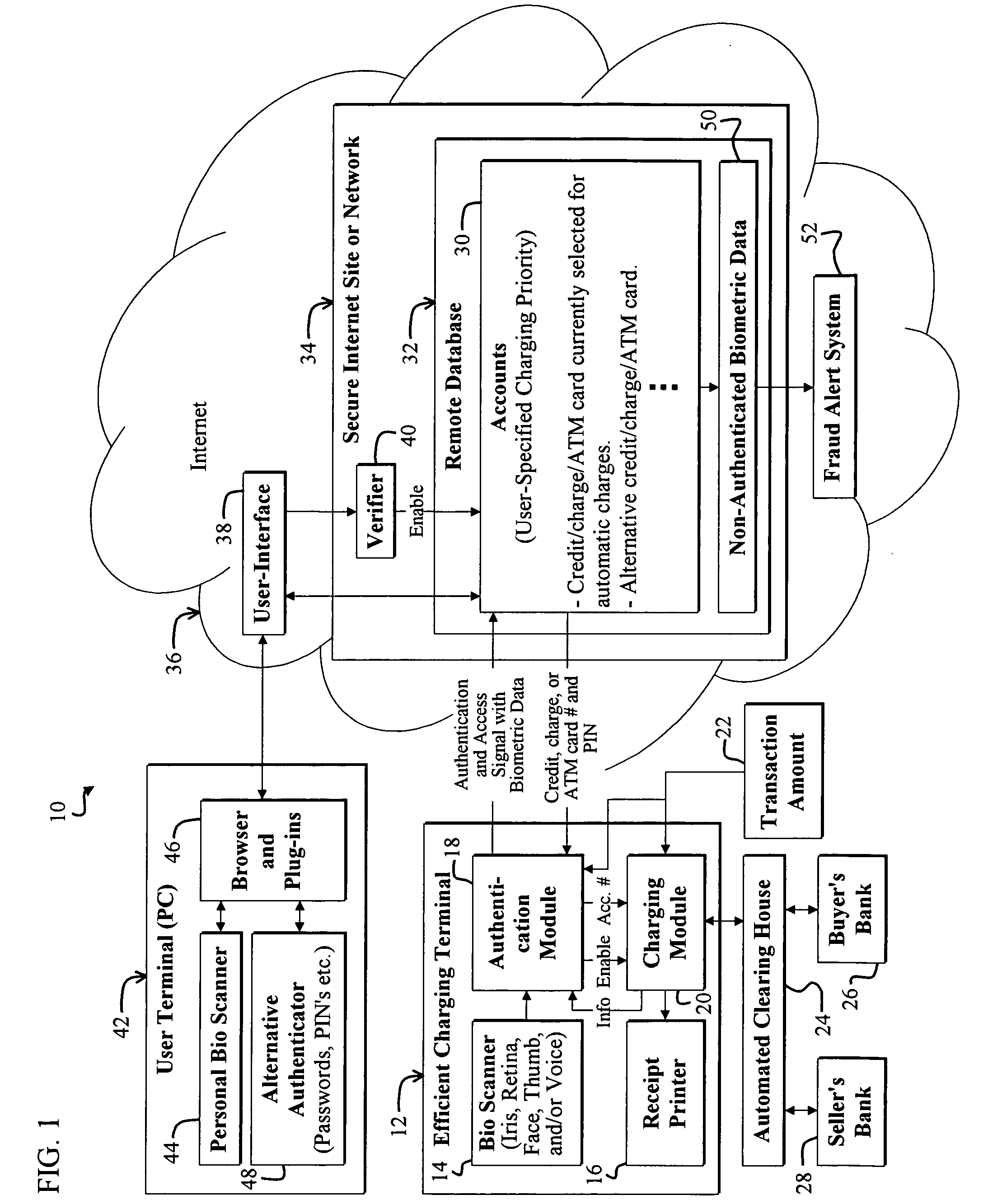

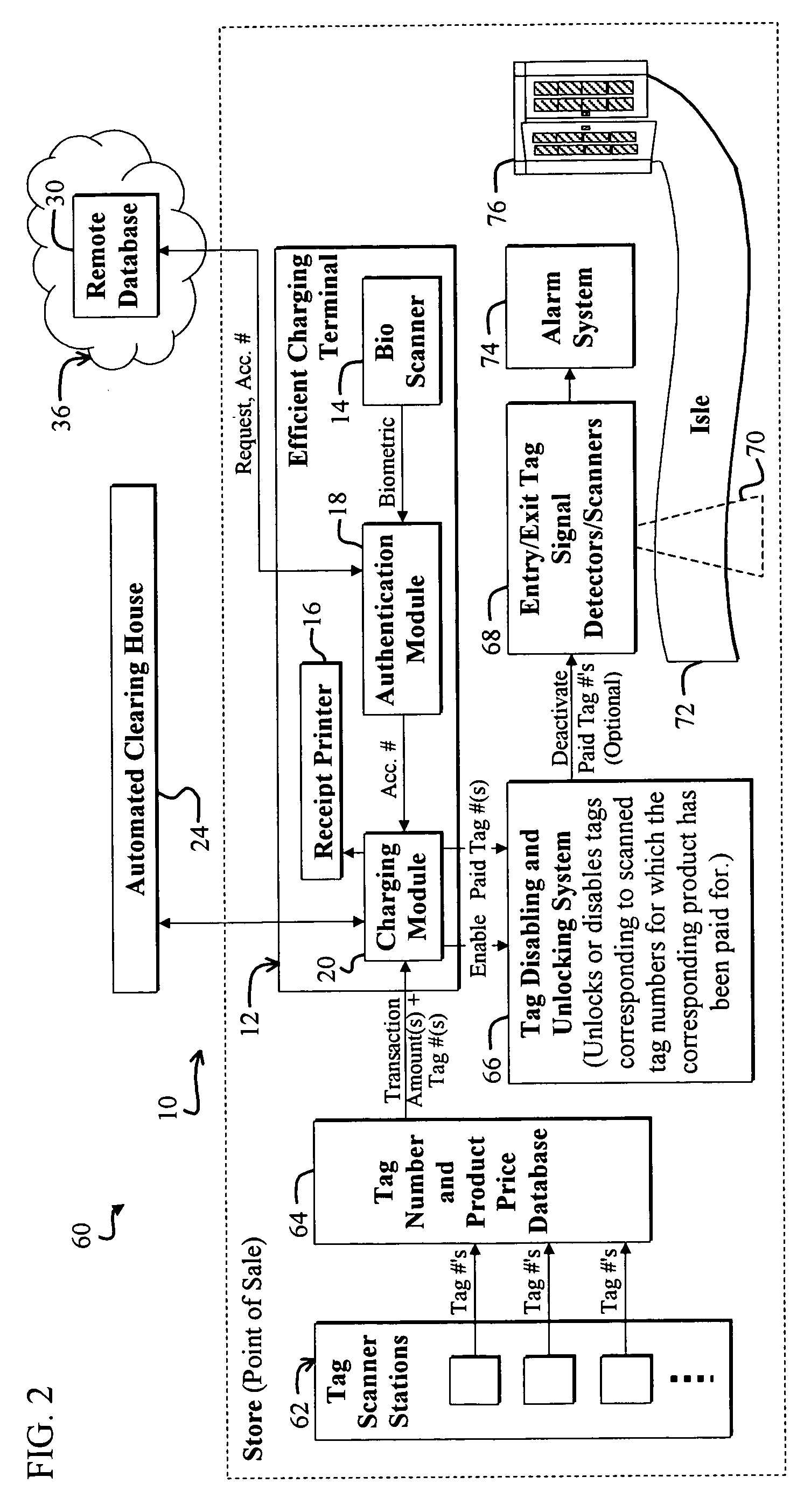

System and method for facilitating monetary transactions

A system for facilitating transactions. The system includes a charging terminal capable of charging an account based on an account number. A scanner obtains biometric information. A first mechanism employs the biometric information to automatically provide an account number to the charging terminal. In a specific embodiment, the first mechanism is a credit card or Automated Teller Machine terminal (ATM), and the account number includes a credit number or ATM number. The first mechanism automatically selects from among plural accounts based on the biometric information. A second mechanism enables a user to control which account number is selected in response to retrieval of biometric information by the scanner. A third mechanism enables the user to prioritize plural accounts. The highest priority account is selected for automatic charging via the system. In an illustrative embodiment, a seventh mechanism automatically provides transaction information to the charging terminal. The seventh mechanism wirelessly interrogates product tags associated with products to be purchased and computes a total in response thereto and forwards the total to the charging terminal.

Owner:DE SYLVA ROBERT FRANCIS

Automated banking machine system and method

A card actuated automated banking machine (152, 198, 200) includes a plurality of transaction function devices. The transaction function devices include a card reader (170), a printer (174), a bill dispenser (176), a coin dispenser (178), a display (182), a check imaging device (186) and at least one processor (190). The automated banking machine is operative responsive to receiving a check and certification data to dispense cash in exchange for the check. The person presenting the check need not provide user identifying inputs through input devices in order to receive cash for the check. A check recipient prior to presenting the check for payment is also enabled to verify that the check will be paid through communication with at least one computer (204) through at least one consumer interface device (208).

Owner:DIEBOLD SELF SERVICE SYST DIV OF DIEBOLD NIXDORF INC

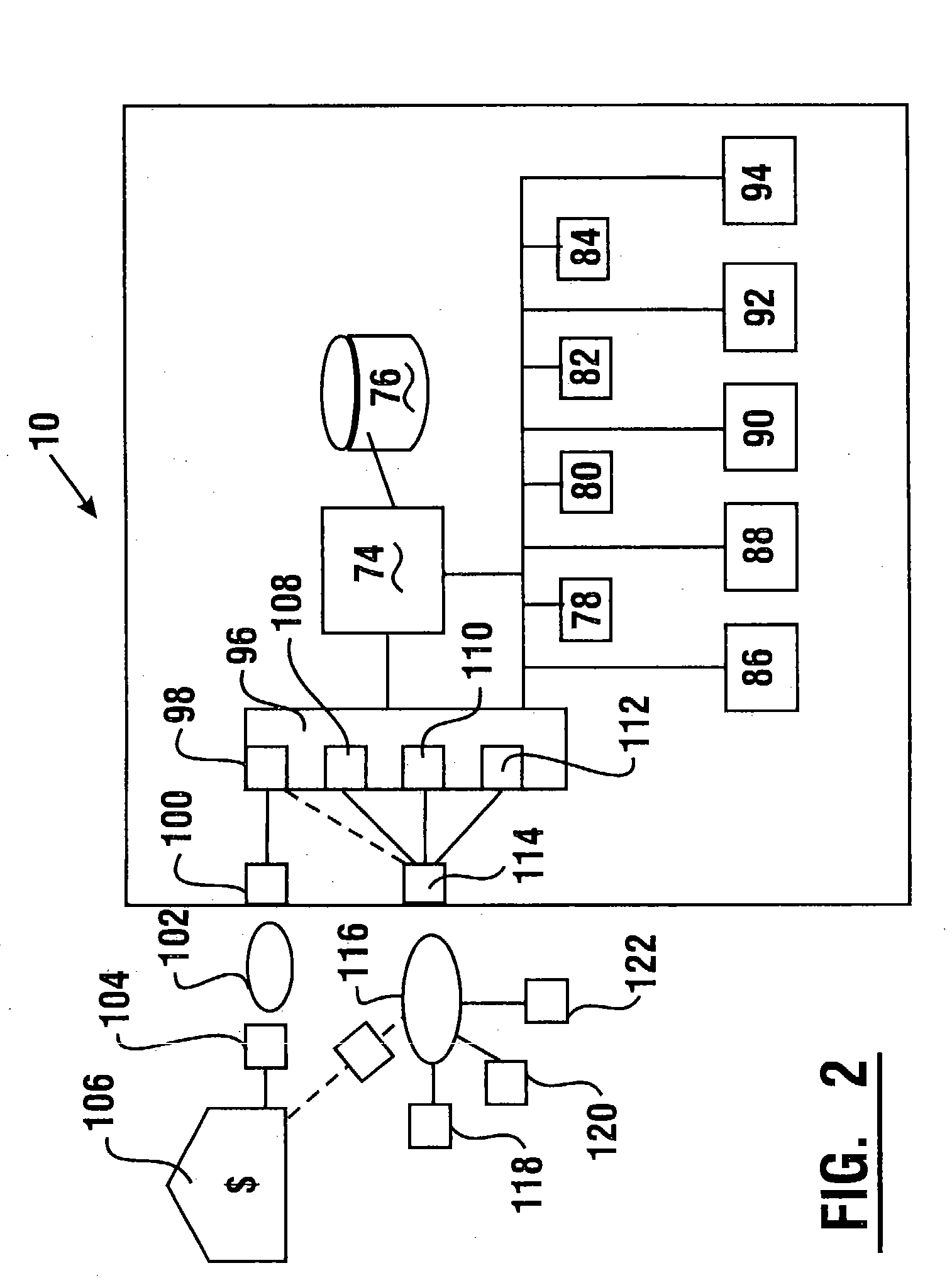

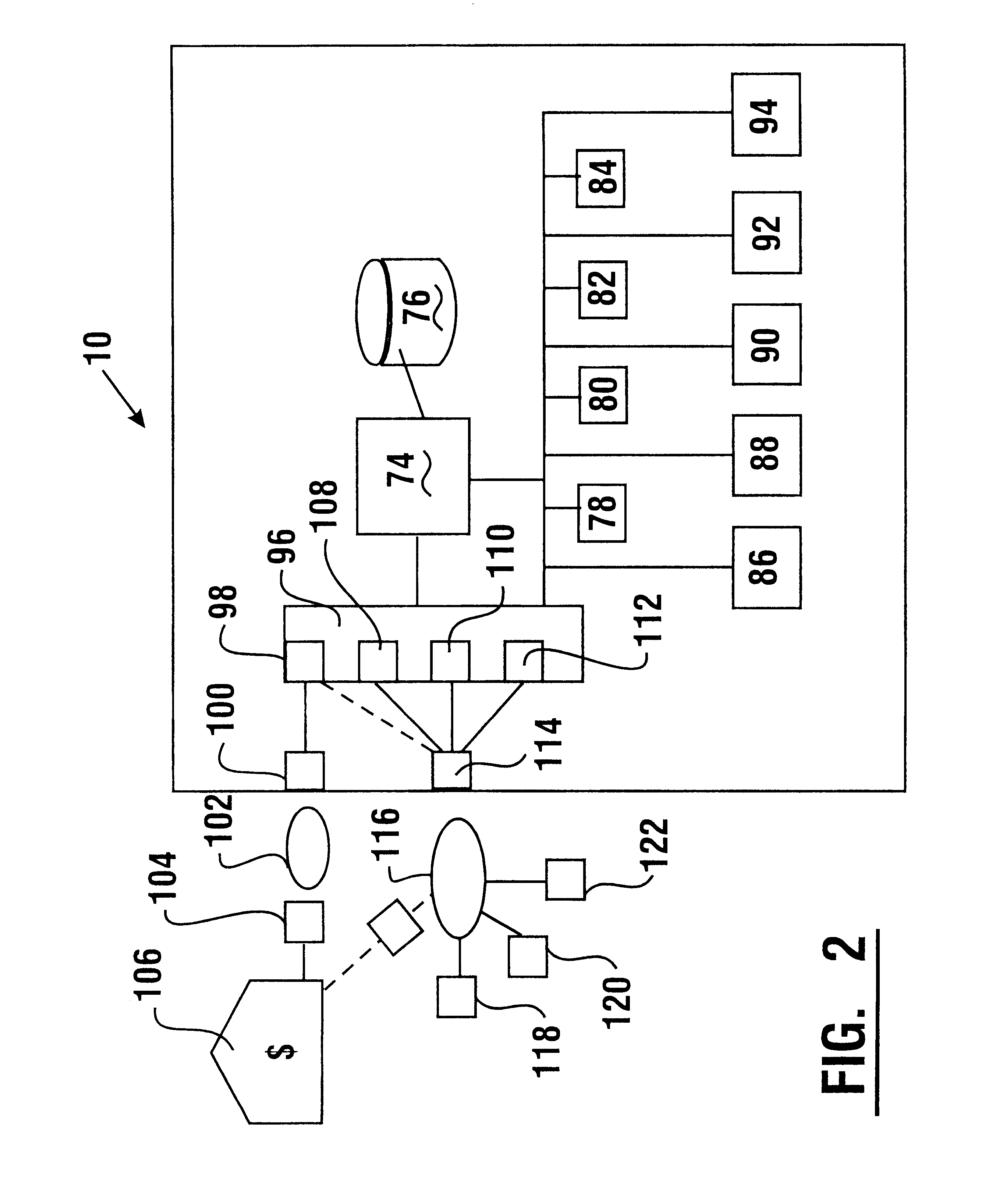

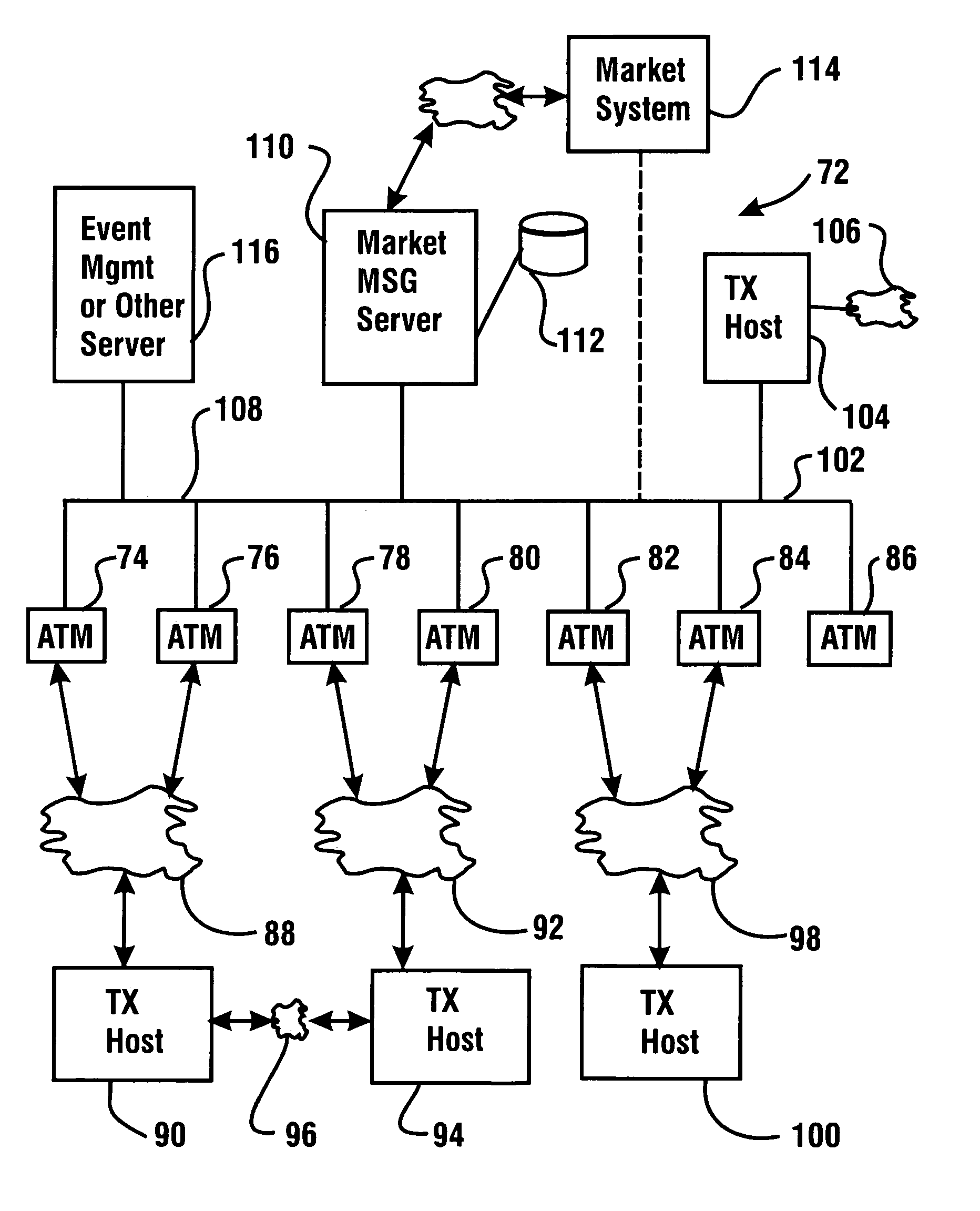

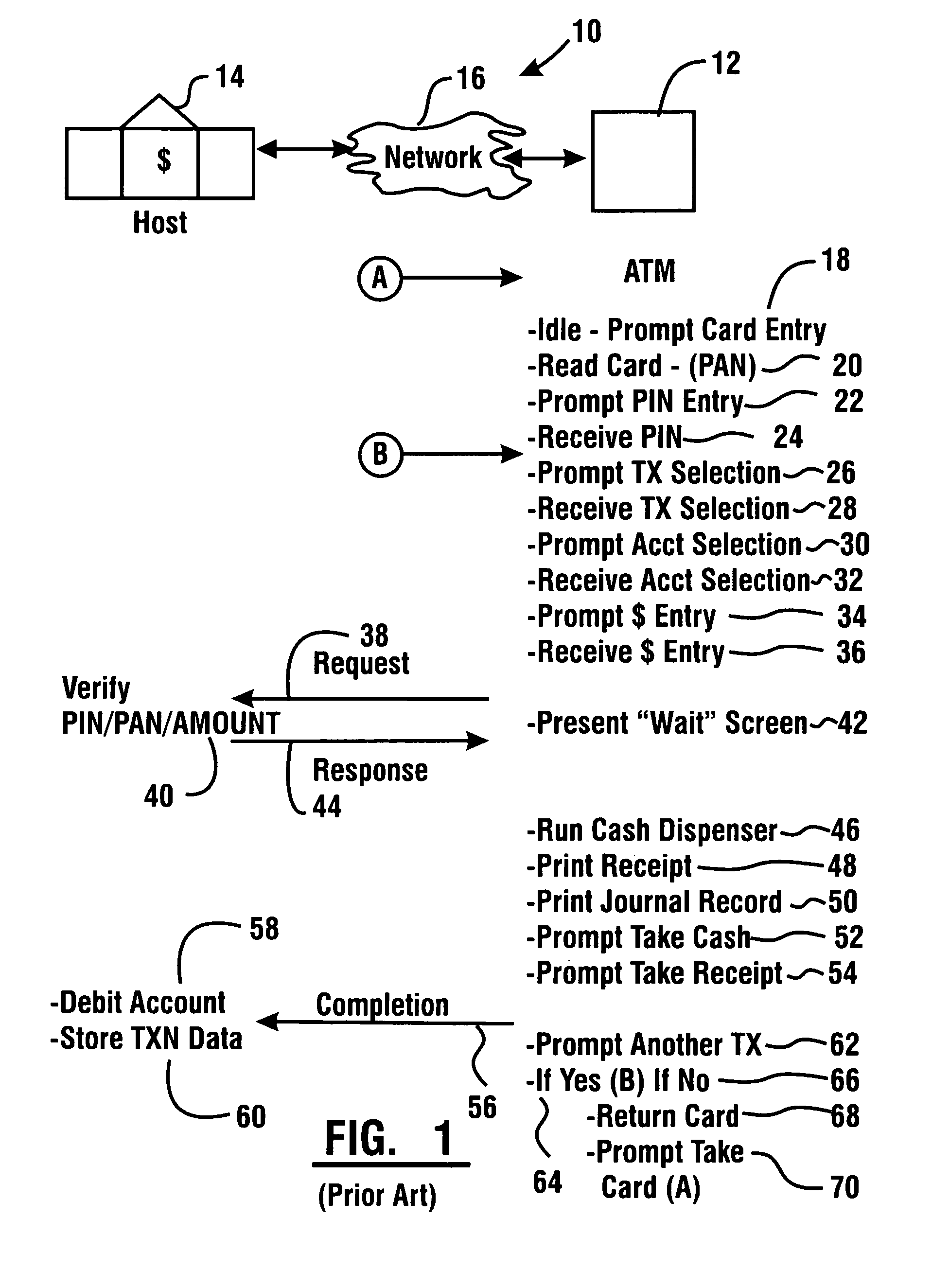

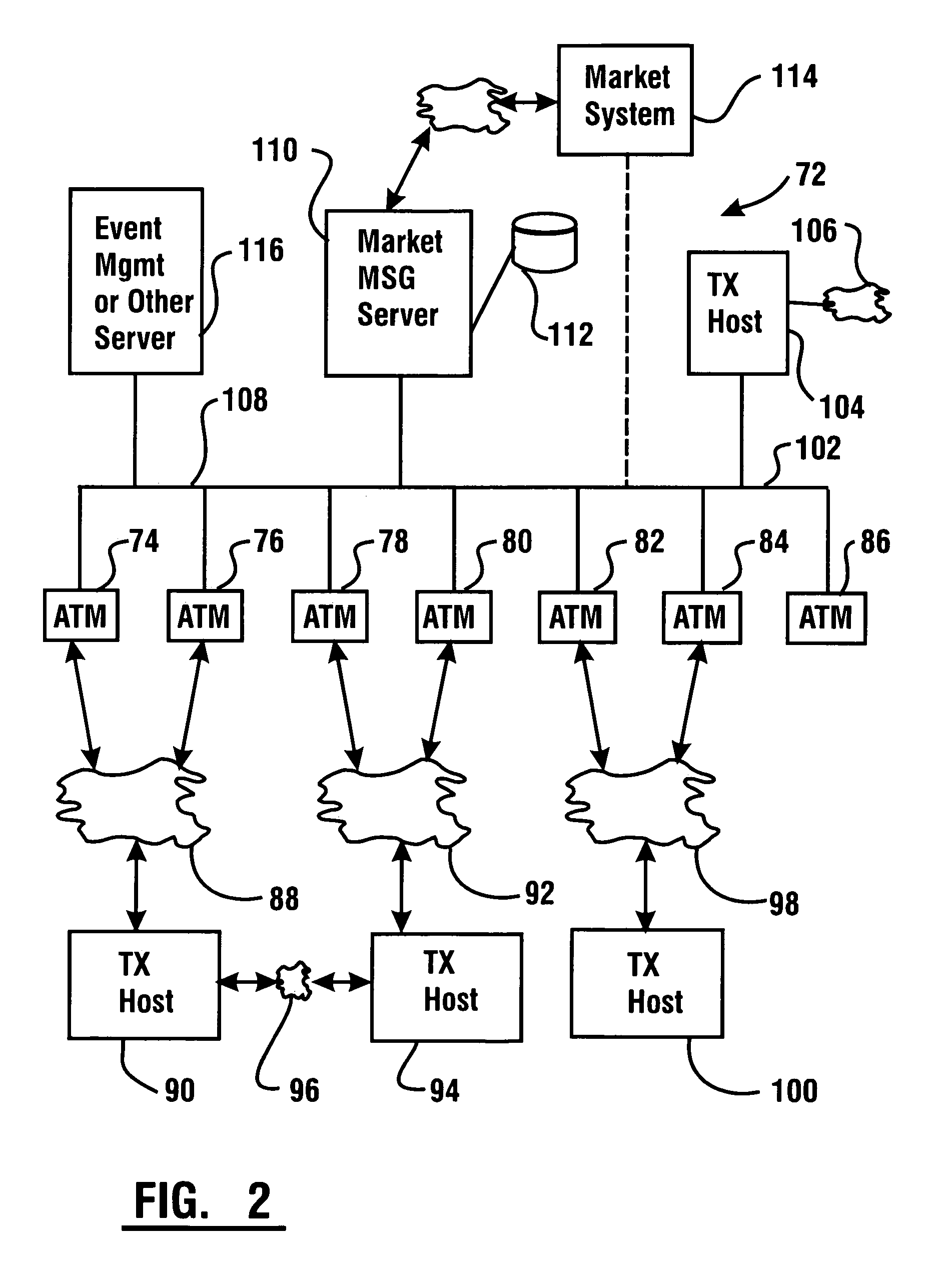

ATM customer marketing system

InactiveUS7039600B1Improve efficiencyComplete banking machinesDiscounts/incentivesFinancial transactionDatabase

A marketing system includes a plurality of automated transaction machines (74, 76, 78, 80, 82, 84, 86). The automated transaction machines operate to carry out financial transactions with associated host computers (90, 94, 100, 104). Marketing presentations are stored on and output from the transaction machines responsive to messages exchanged with a market message server (110) which is connected to the automated transaction machines through a network (108). The connection to the automated transaction machines which provides delivery of the market presentation materials and which causes the output of presentations, is generally independent of the messages associated with authorizing financial transactions. Some described embodiments of the invention enable presenting marketing campaigns to users of the transaction machines. The marketing campaigns may include sequences of presentations that are output on a targeted basis to particular users.

Owner:DIEBOLD NIXDORF

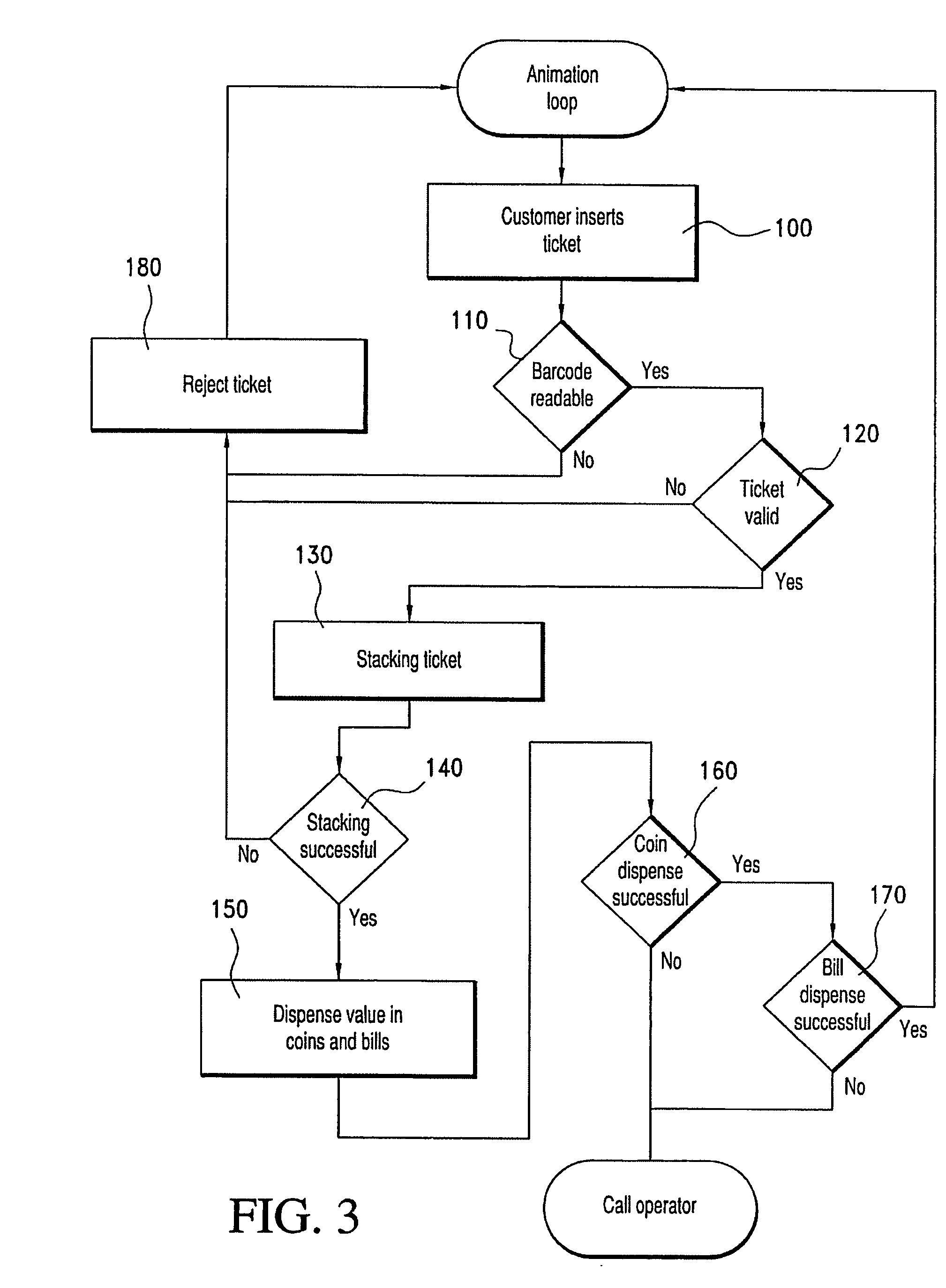

Casino all in kiosk for cash, tickets, and cards, with card issuing capability

A casino all-in-one kiosk includes a card issuing unit that enables self service registration and dispensing of casino loyalty cards, in addition to cash-dispensing, and ticket redemption functions. The kiosk may also be adapted to provide ancillary services such as hotel check-in / check-out, reservations and ticketing, and coupon printing, and may further be integrated with a financial services network to provide banking and credit card services.

Owner:GIESECKEDEVRIENT CURRENCY TECH AMERICA INC

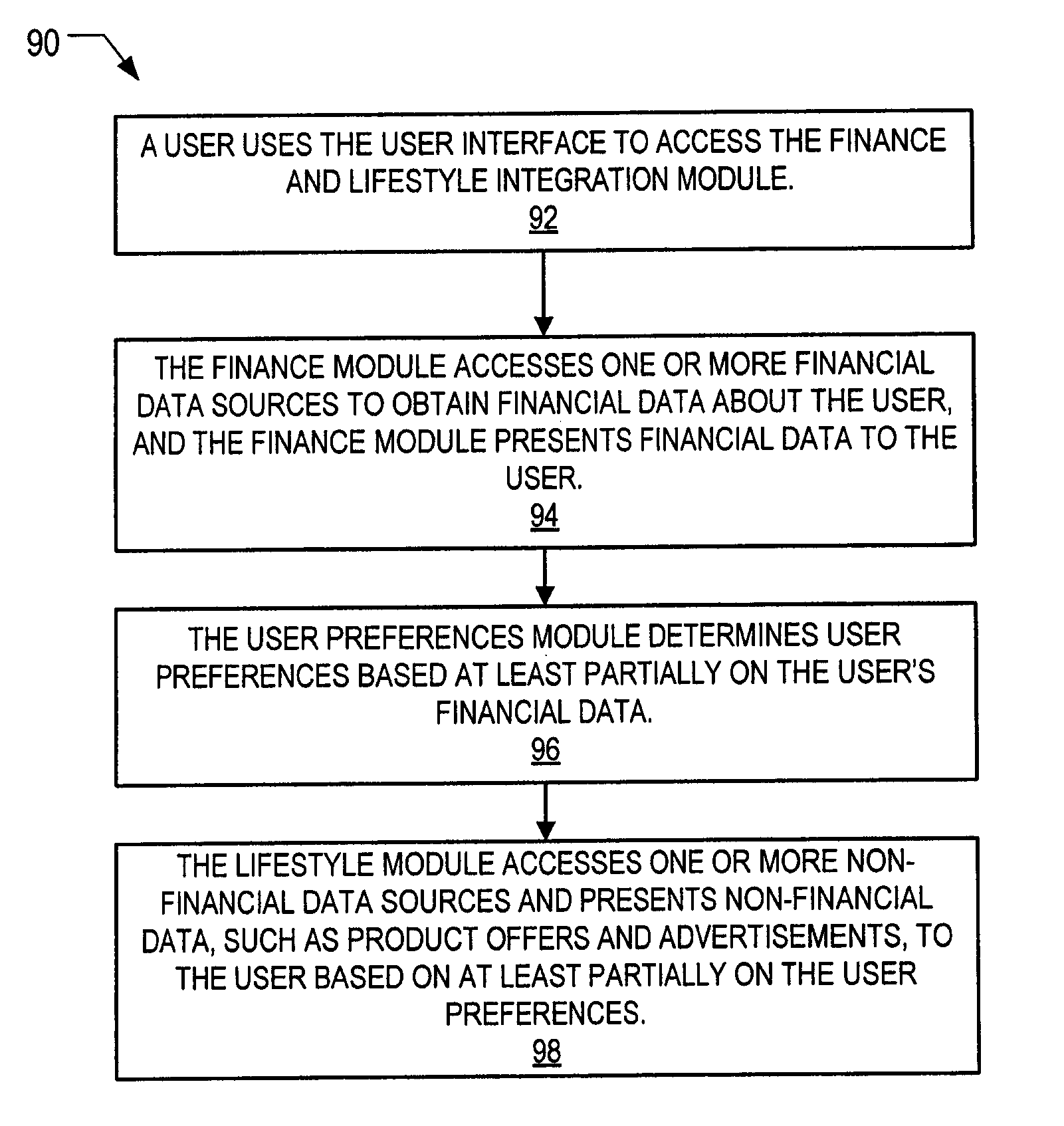

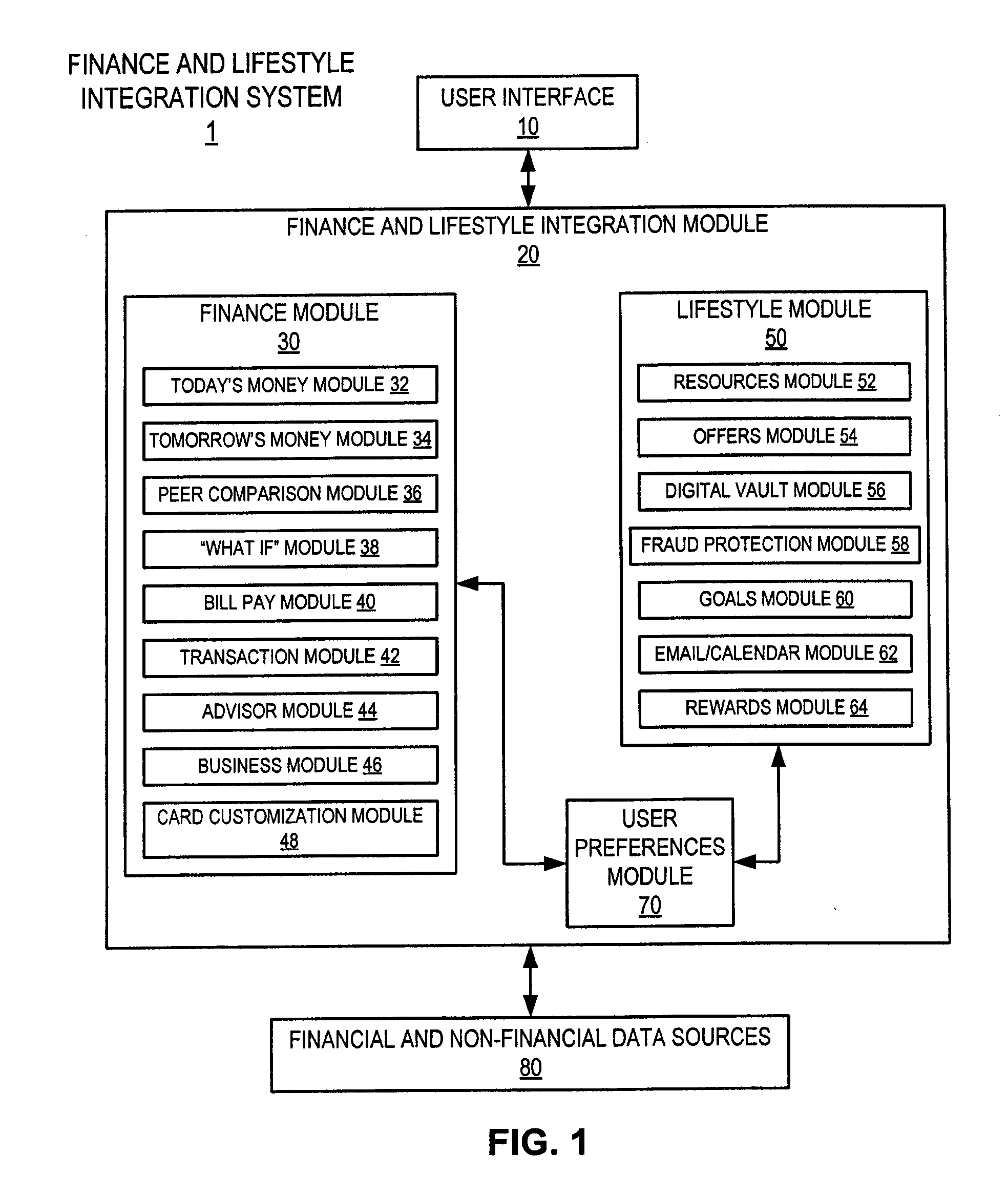

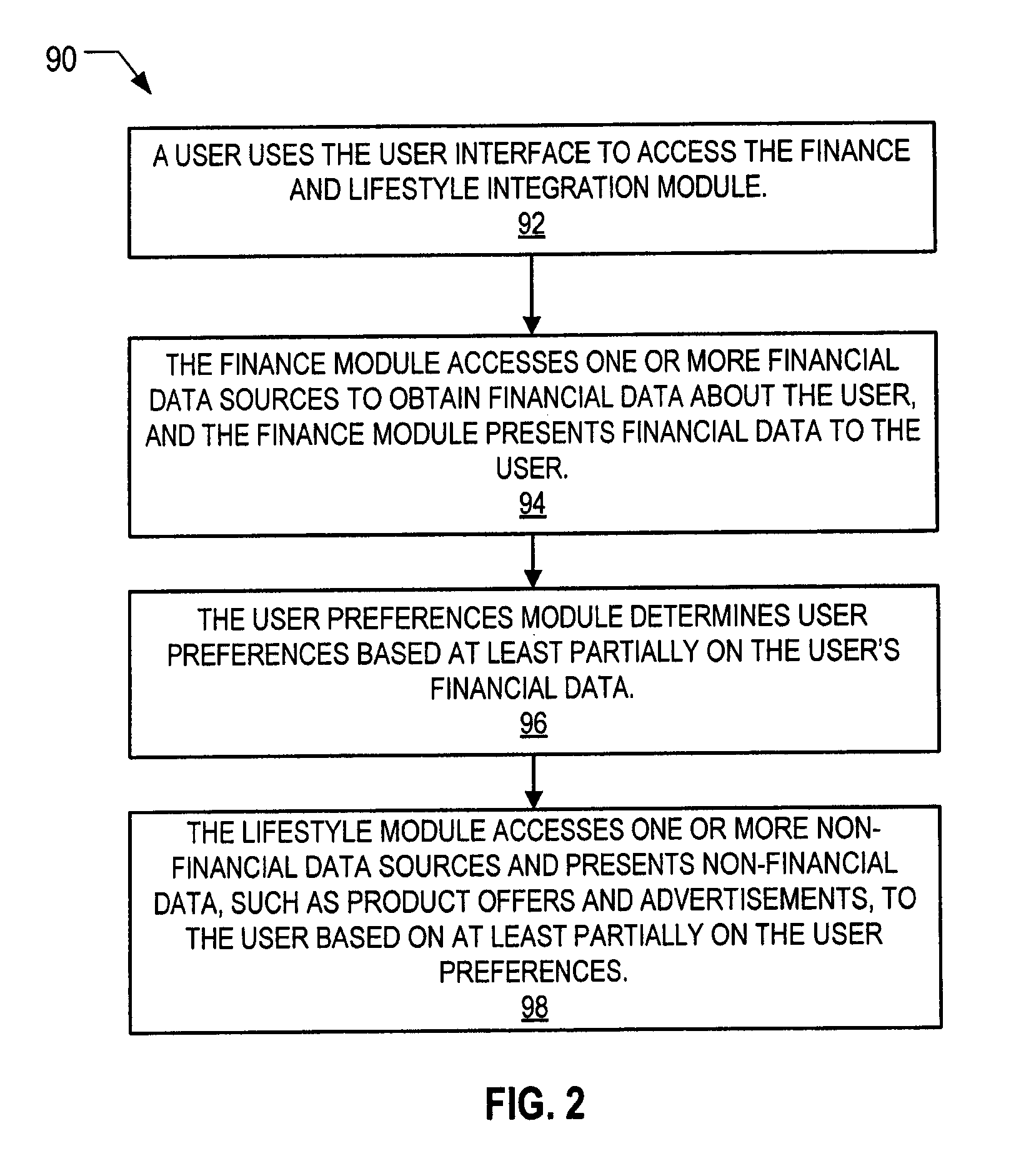

Tools for relating financial and non-financial interests

InactiveUS20100100424A1Improve customer serviceGood serviceFinancePayment architectureGraphicsGraphical user interface

Embodiments of the invention provide an apparatus having processor configured to: (a) provide a user with access to the user's financial account via a graphical user interface; (b) determine user preferences based at least partially on the user's financial information; and (c) provide non-financial content to the user via the graphical user interface and based at least partially on the user preferences. In one embodiment, the processor is configured to determine user preferences by determining trends in the user's financial information. In one embodiment, the processor is configured to determine user preferences by distinguishing between user financial transactions that are regular and user financial transactions that are ad hoc.

Owner:BANK OF AMERICA CORP

Currency recycling automated banking machine

InactiveUS6290070B1Easy to operateFacilitate rapid operation of machinePayment architectureSortingMachine selectionDocumentation

An automated banking machine (10) identifies and stores documents such as currency bills deposited by a user. The machine then selectively recovers such documents from storage and dispenses them to other users. The machine includes a central transport (70) wherein documents deposited in a stack are unstacked, oriented and identified. Such documents are then routed to storage areas in recycling canisters (92, 94, 96, 98). When a user subsequently requests a dispense, documents stored in the storage areas are selectively picked therefrom and delivered to the user through an input / output area (50) of the machine.

Owner:DIEBOLD NIXDORF

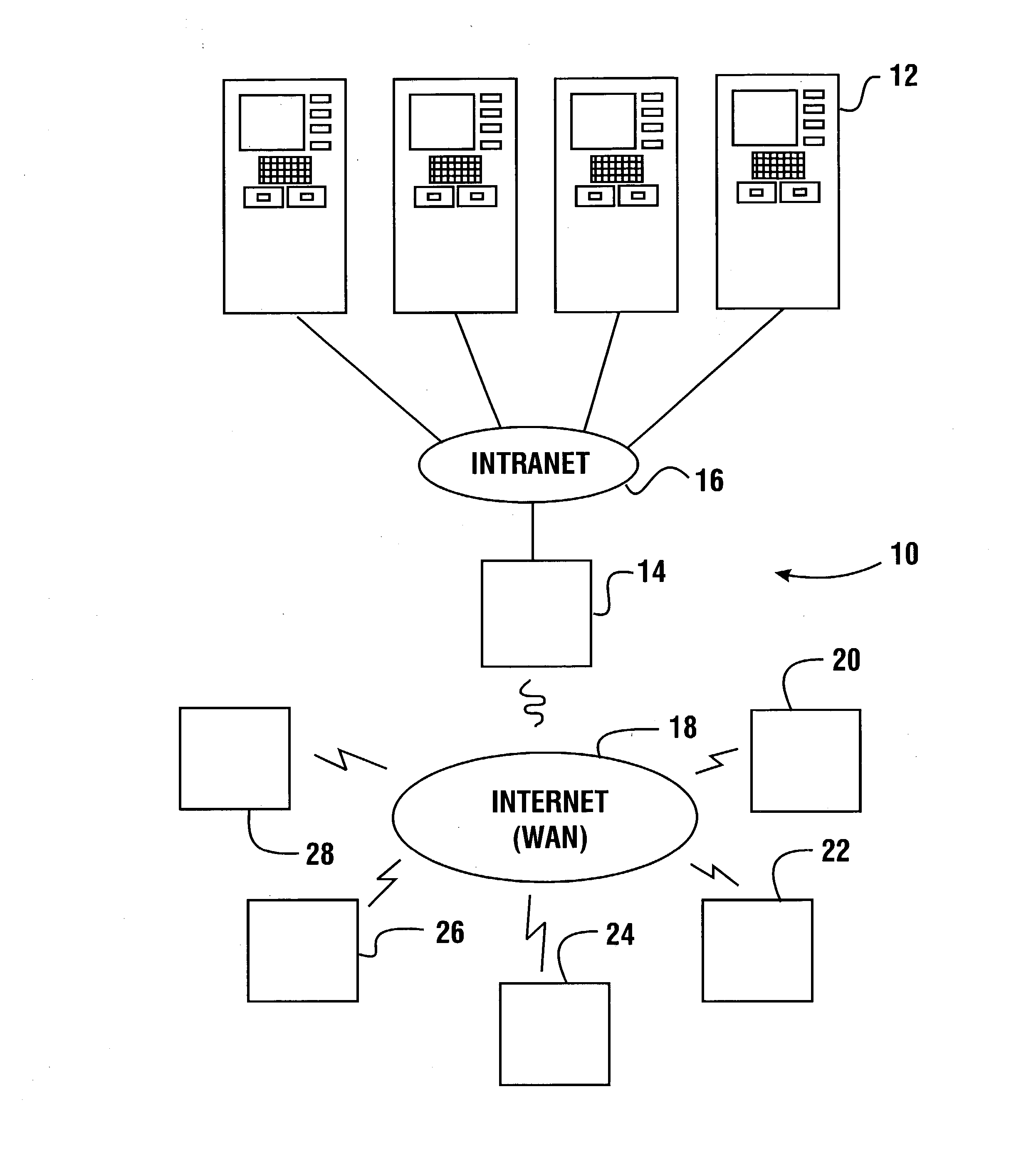

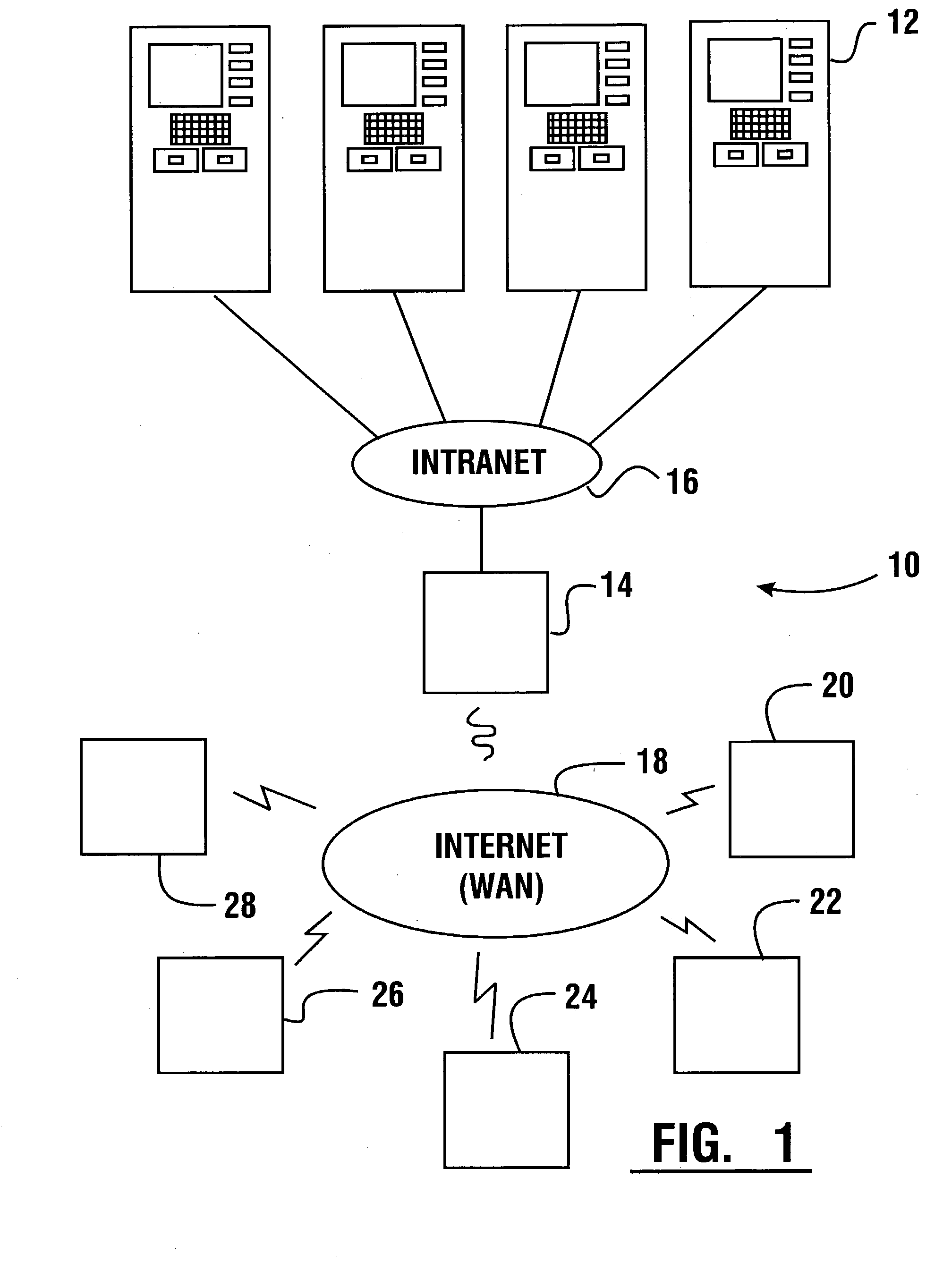

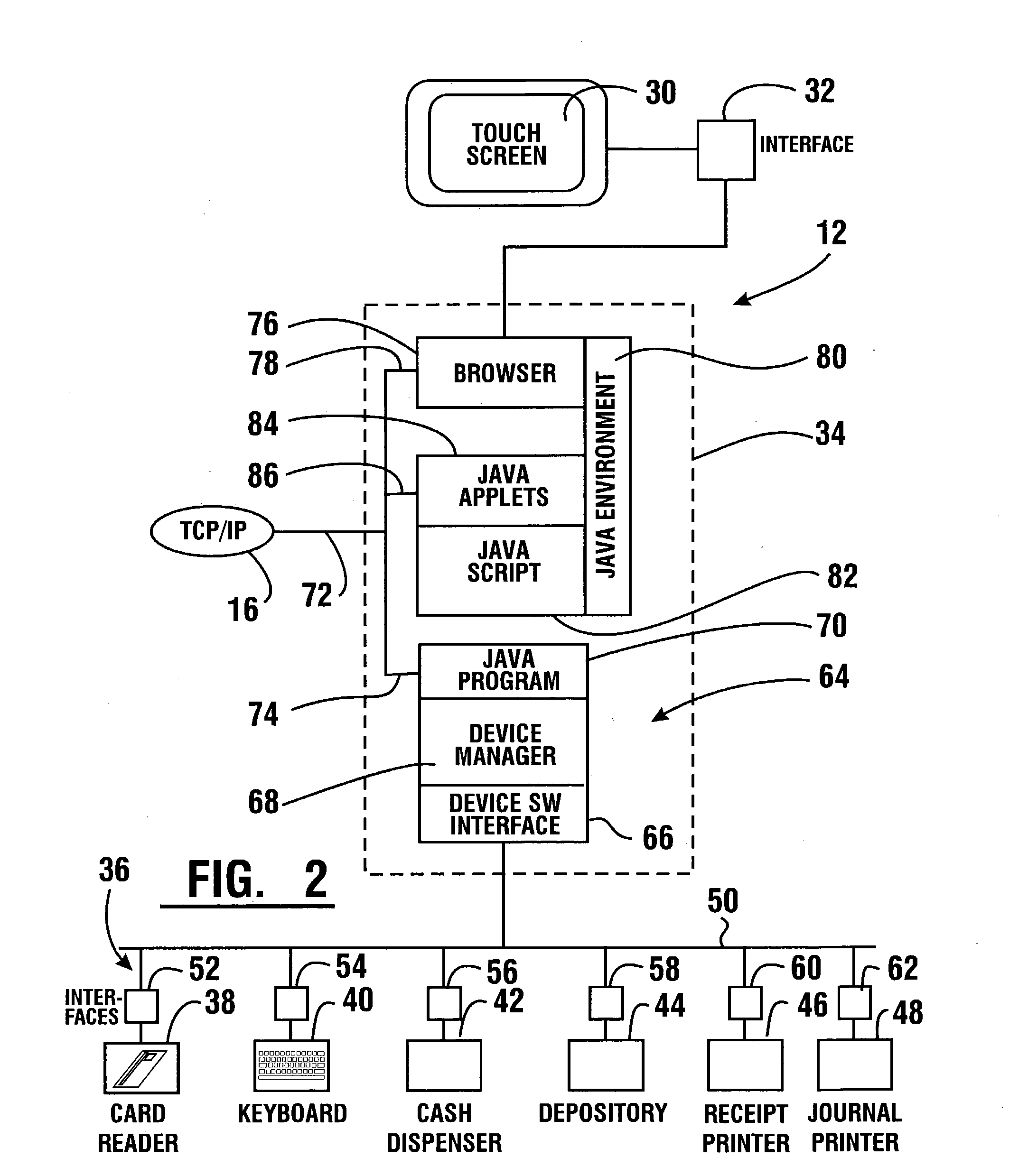

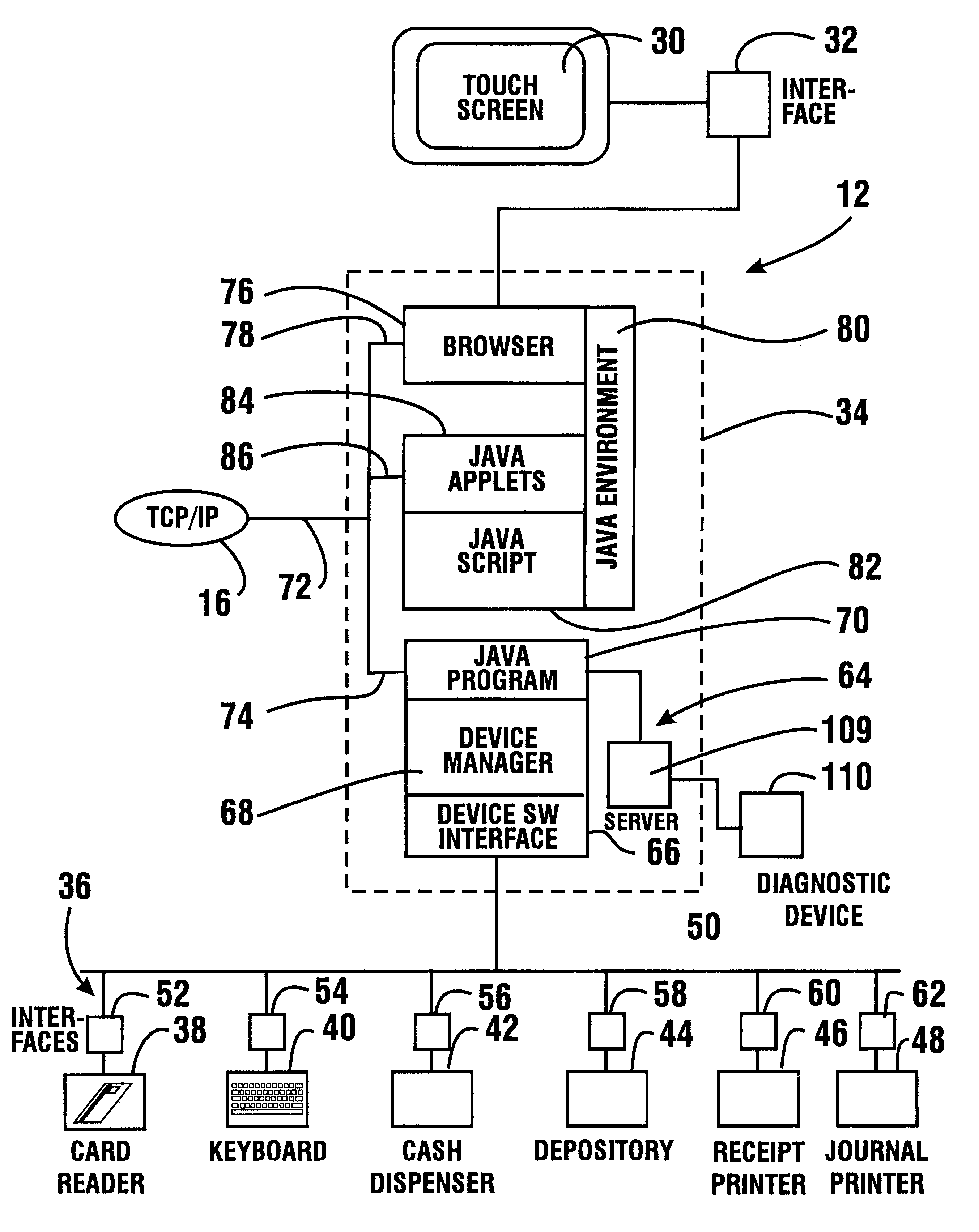

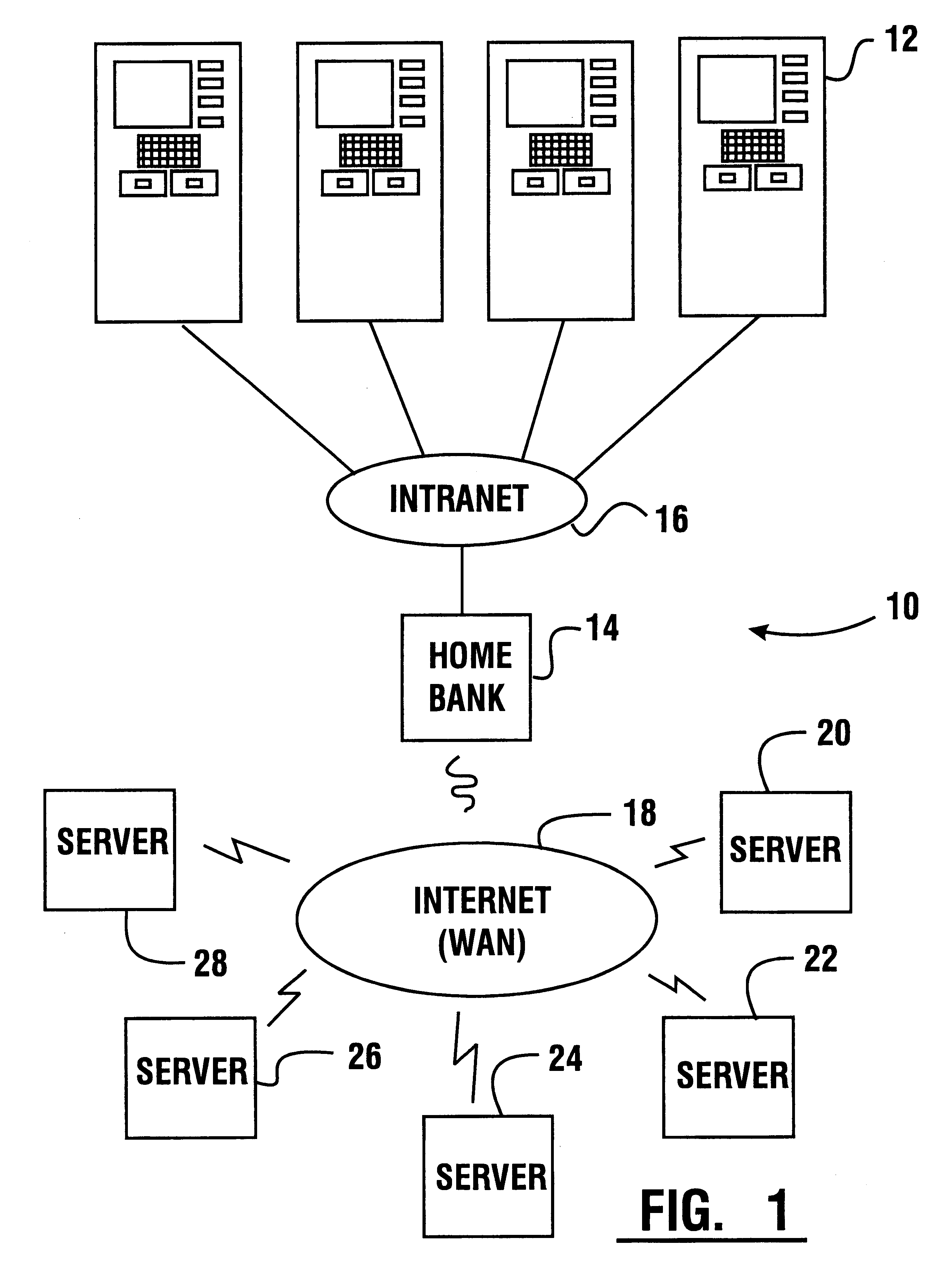

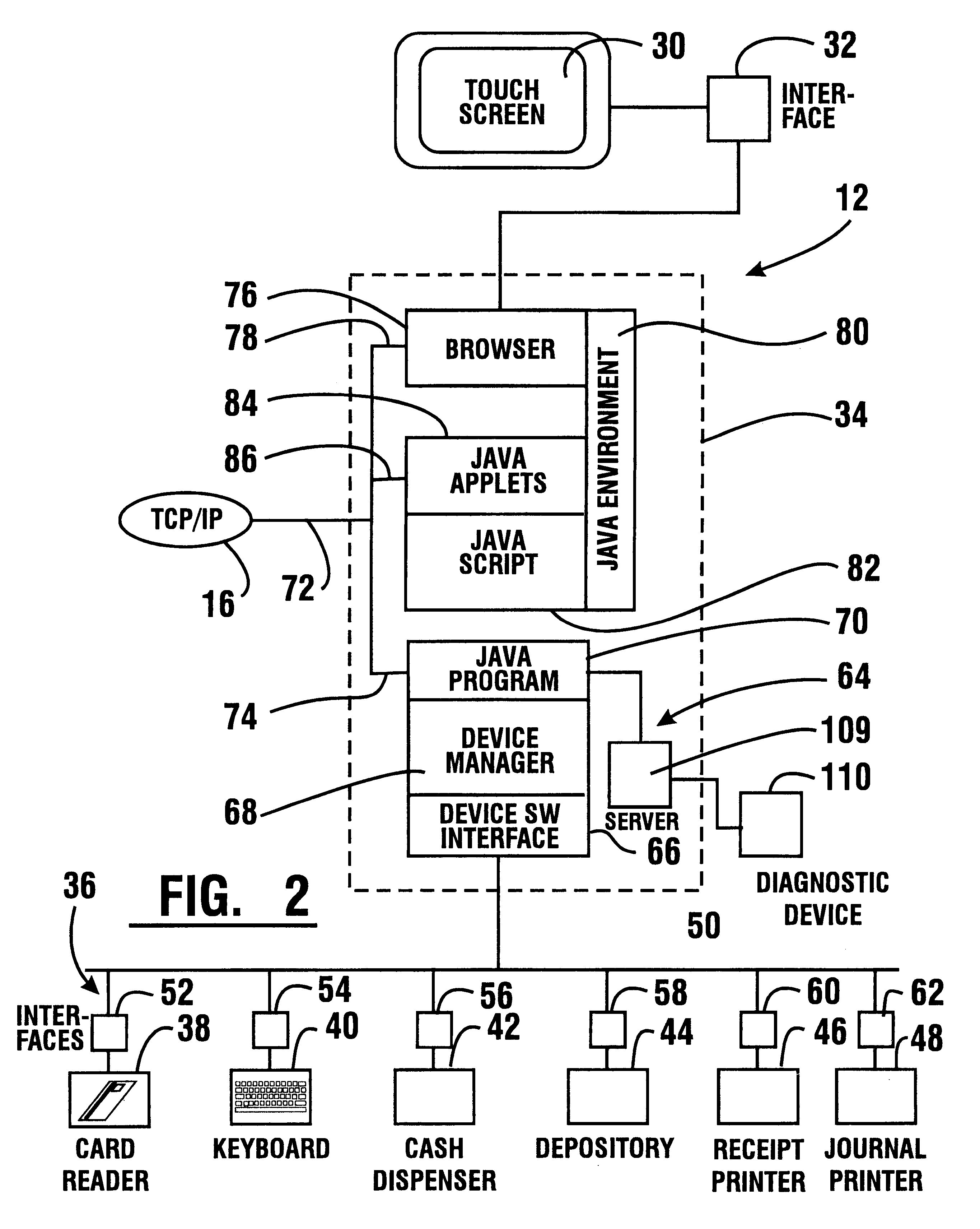

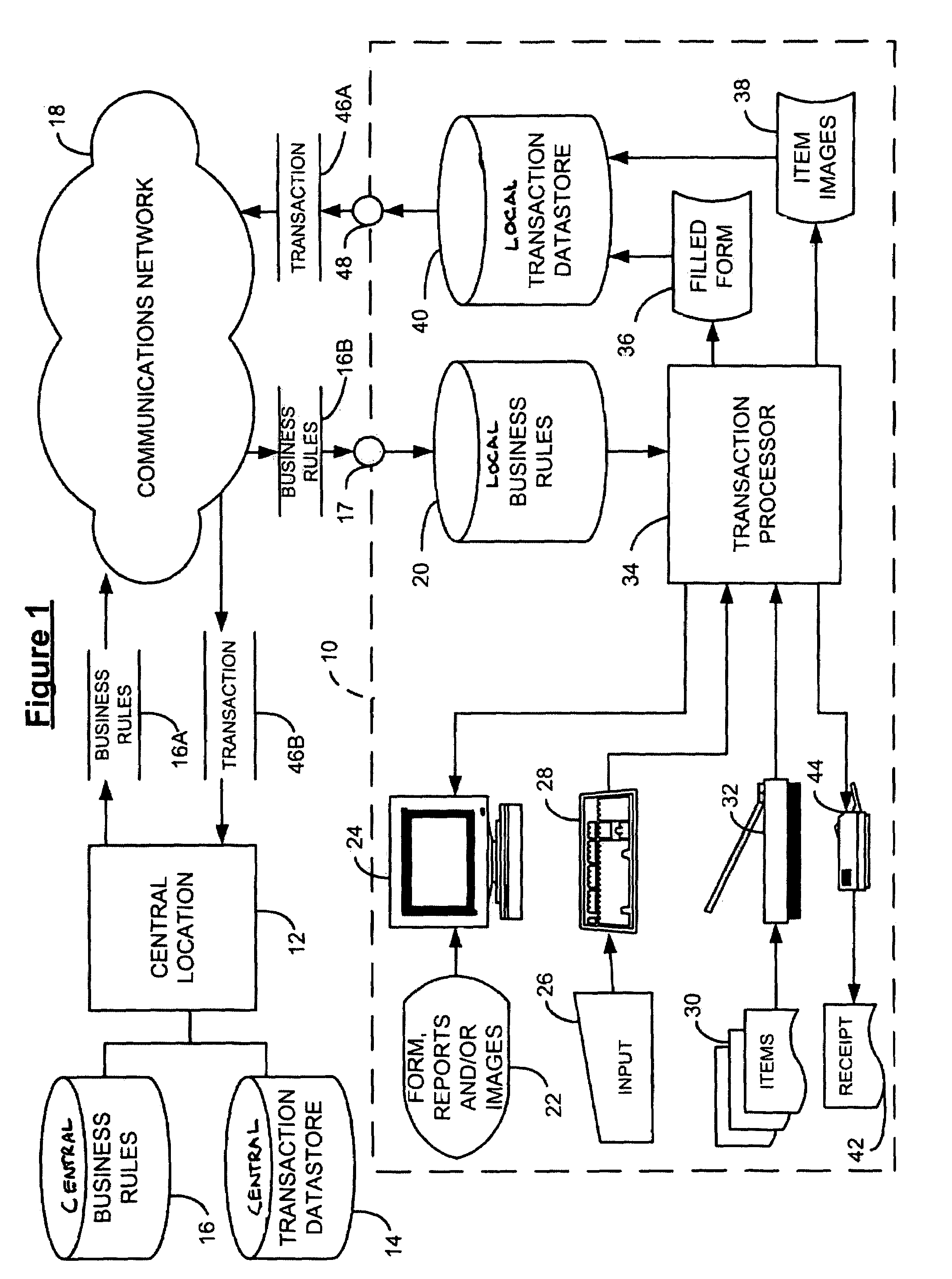

Automated banking machine apparatus and system

InactiveUS6289320B1Easy to operateMaintain securityPayment architectureSpecial data processing applicationsDocument handlingApplication software

An automated banking machine (12) is operative to conduct transactions in response to HTML documents and TCP / IP messages exchanged with a local computer system (14) through an intranet (16), as well as in response to messages exchanged with foreign servers (20, 22, 24, 26, 28, 96) in a wide area network (18). The banking machine includes a computer (34) having an HTML document handling portion (76, 80, 82). The HTML document handling portion is operative to communicate through a proxy server (88), with a home HTTP server (90) in the intranet or the foreign servers in the wide area network. The computer further includes a device application portion (84) which interfaces with the HTML document handling portion and dispatches messages to operate devices (36) in the automated banking machine. The devices include a sheet dispenser mechanism (42) which dispenses currency as well as other transaction devices. The device application portion communicates with a device interfacing software portion (64) in the banking machine through a device server (92) in the intranet. The device server maintains local control over the devices in the banking machine including the sheet dispenser. The banking machine operates to read indicia on the user's card corresponding to a system address. The computer is operative to connect the banking machine to the home or foreign server corresponding to the system address, which connected server operates the banking machine until the completion of transactions by the user.

Owner:DIEBOLD NIXDORF

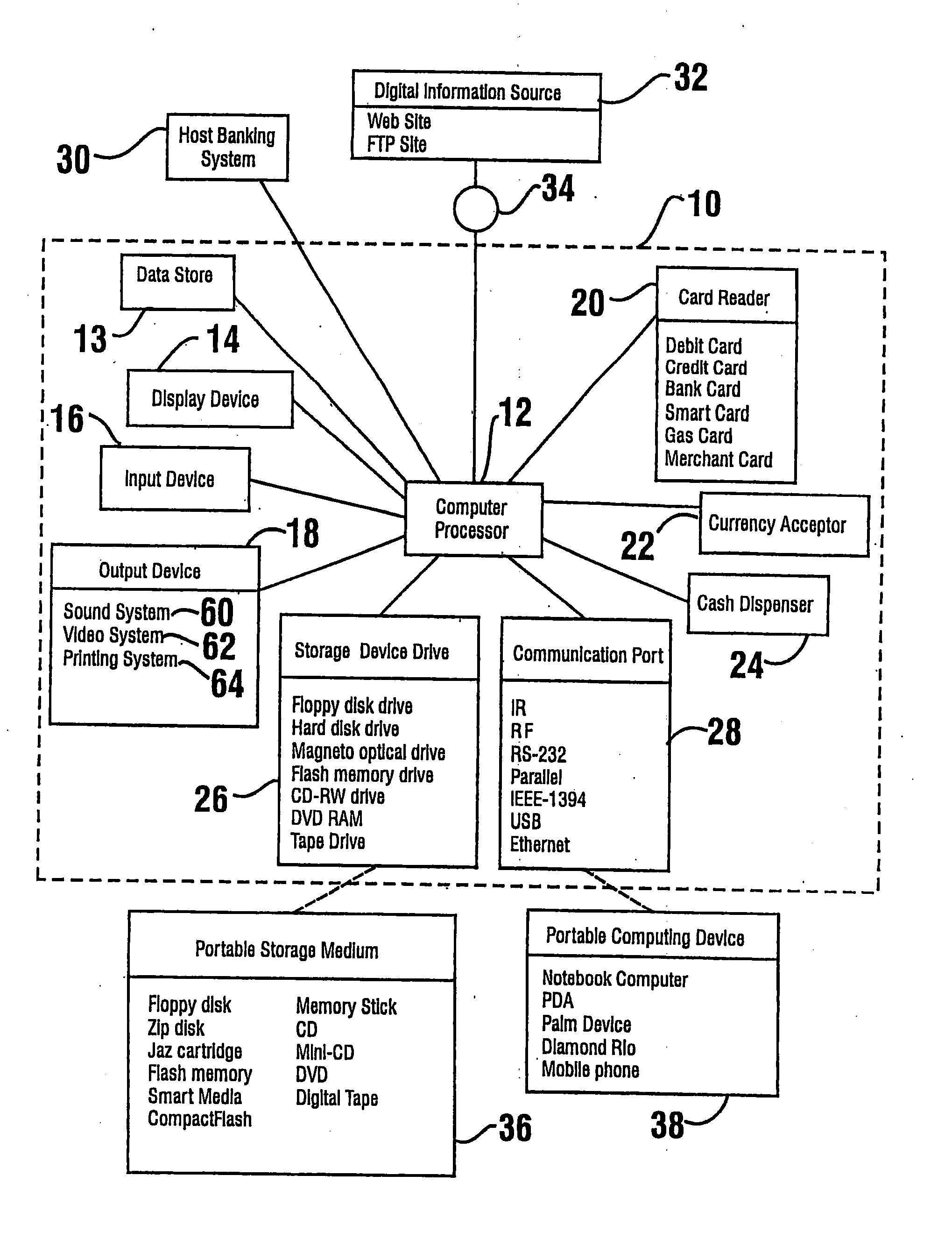

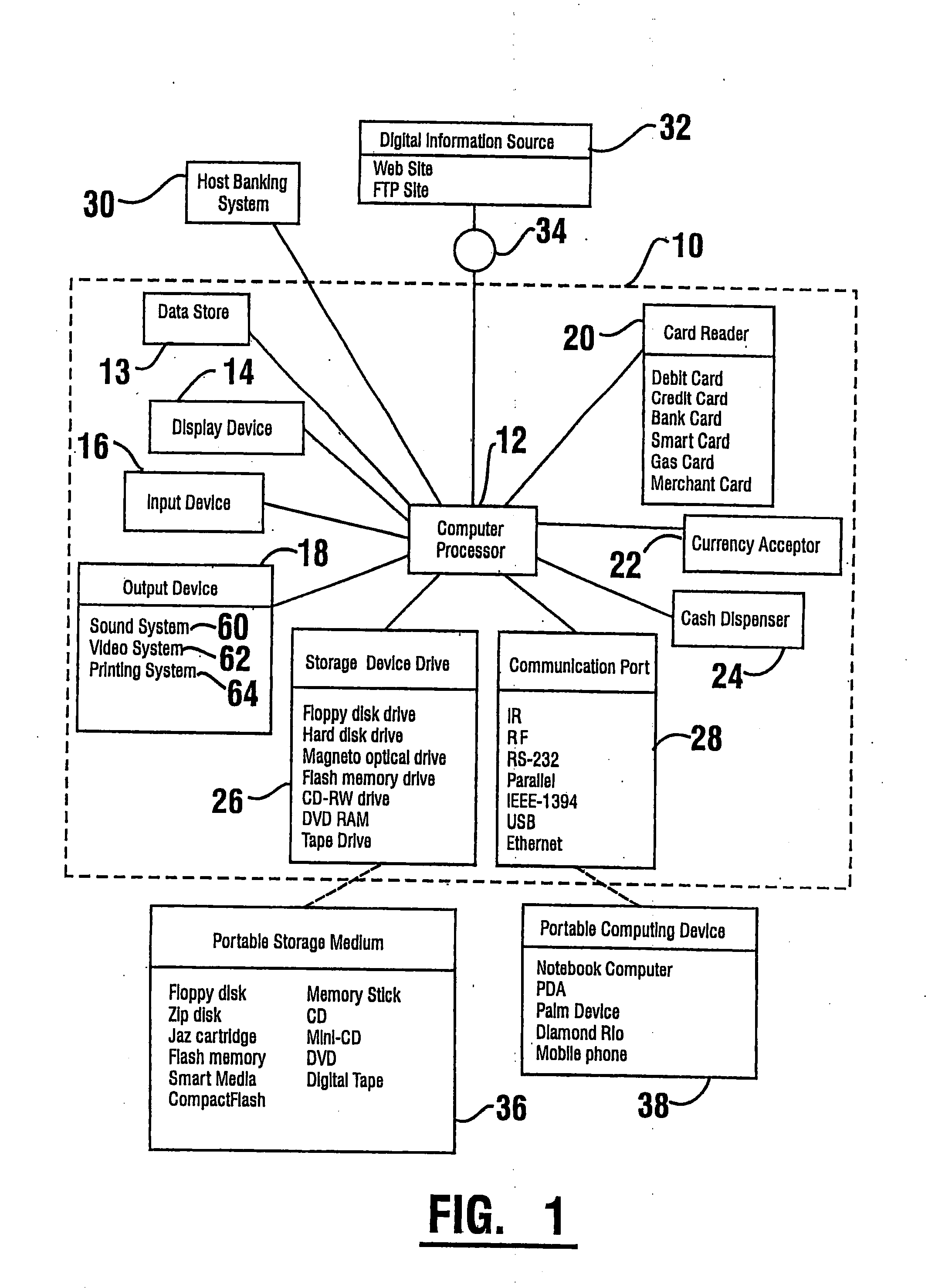

Automated banking machine system and method

Owner:DIEBOLD SELF SERVICE SYST DIV OF DIEBOLD NIXDORF INC

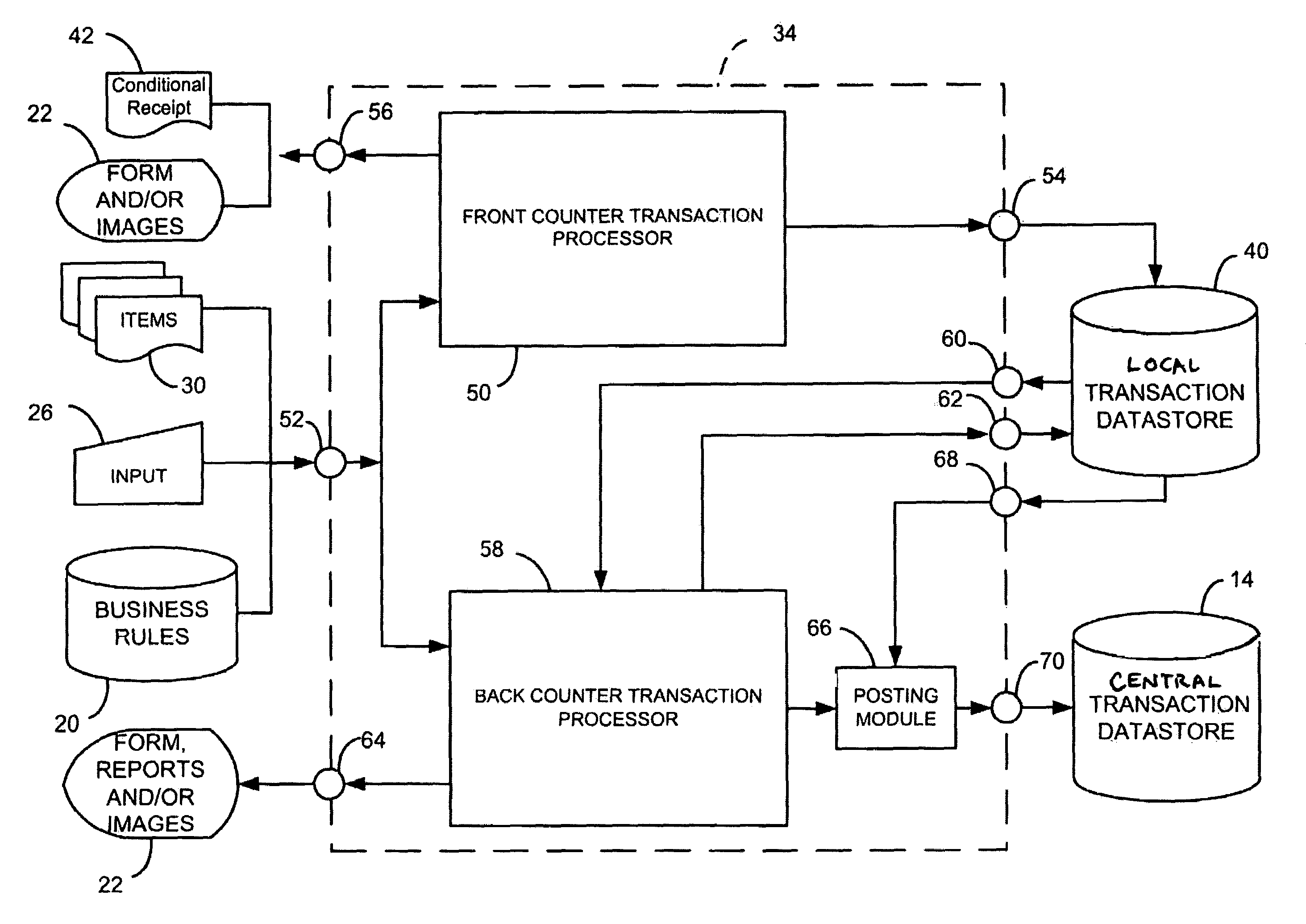

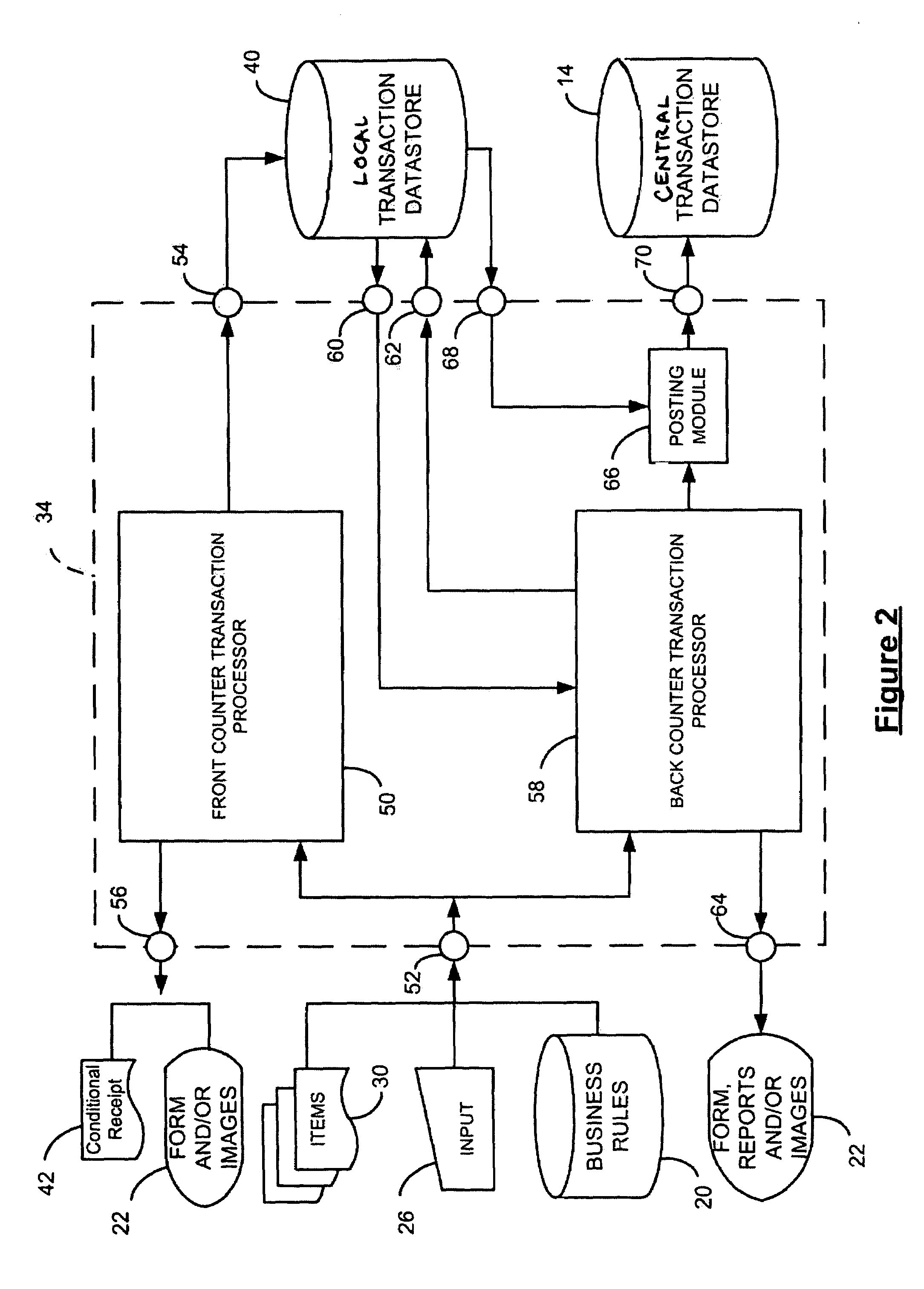

Front counter and back counter workflow integration

A system and method for processing financial transactions includes an input receptive of cash and a plurality of images of physical items of the transaction, wherein the images contain a visual record of the transaction data such as an amount of monetary value. A front, counter transaction processor processes the cash and a first item image and generates front counter transaction data. A back counter transaction processor processes item images of the transaction and generates back counter transaction data. A match module matches back counter transaction data to front counter transaction data. An output is adapted to transmit front counter transaction data and back counter transaction data to at least one of form fields and a temporary transaction datastore.

Owner:ALOGENT CORP

Systems and methods of introducing and receiving information across a computer network

One method involves the use of stored value account that may be used, for example, to make internet payments, and that can be credited using a variety of payment techniques. Such a method involves receiving money at a money transfer location from a potential purchaser. The money is then stored as an electronic record in a stored value account of the purchaser. This money is then available for transfer at the request of the purchaser. Upon such a request, the money may be electronically sent to a recipient and the stored value account may be debited.

Owner:THE WESTERN UNION CO

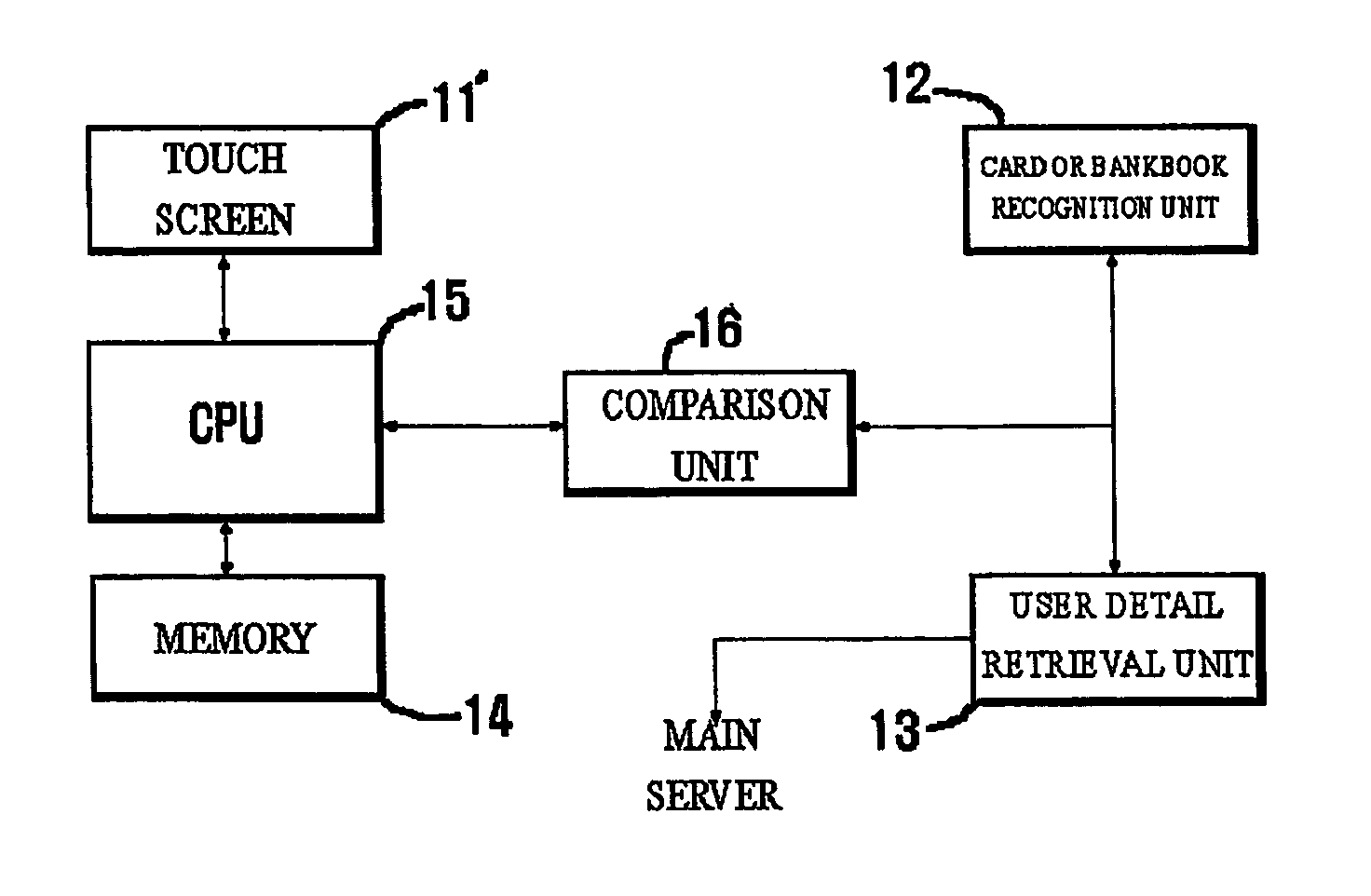

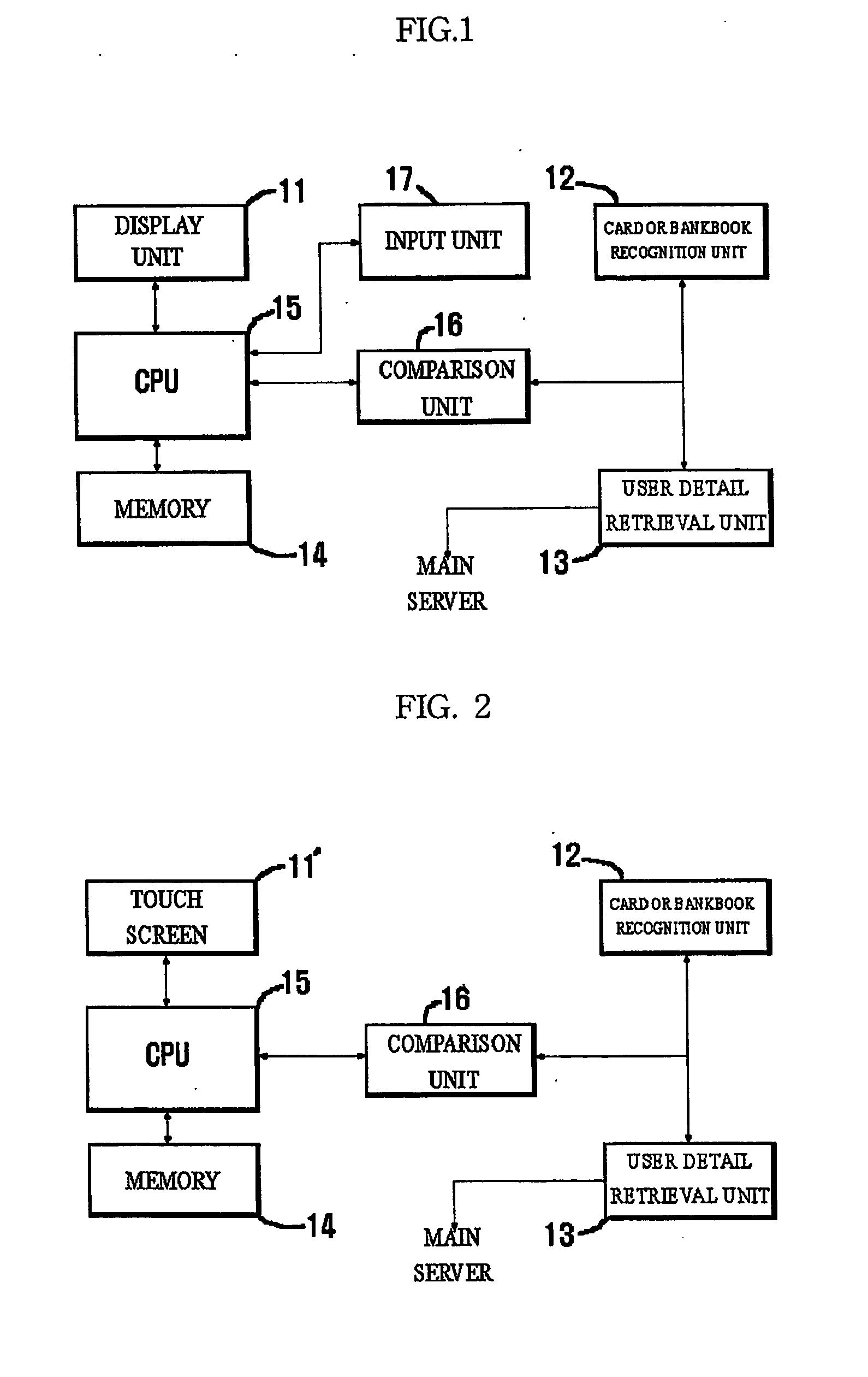

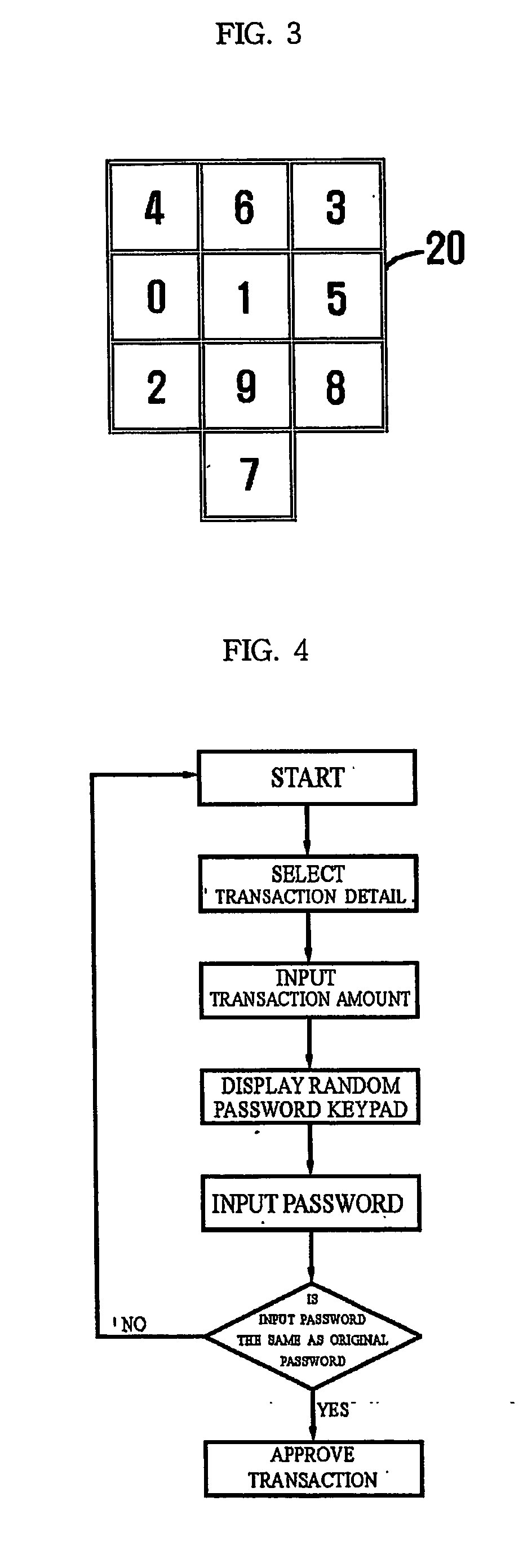

Device and method for inputting password using random keypad

A device and a method for inputting passwords in ATM or door-lock and etc, having display means are provided. In particular, said device comprises a keypad in display means where numbers or letters for passwords are arranged randomly, and further comprises a keypad providing an indirect password numbers or letters randomly arranged, according to an original password, to be input in another indirect password keypad such that the original password of a user can be protected effectively from the others eye.

Owner:SHIN HWA SHIK

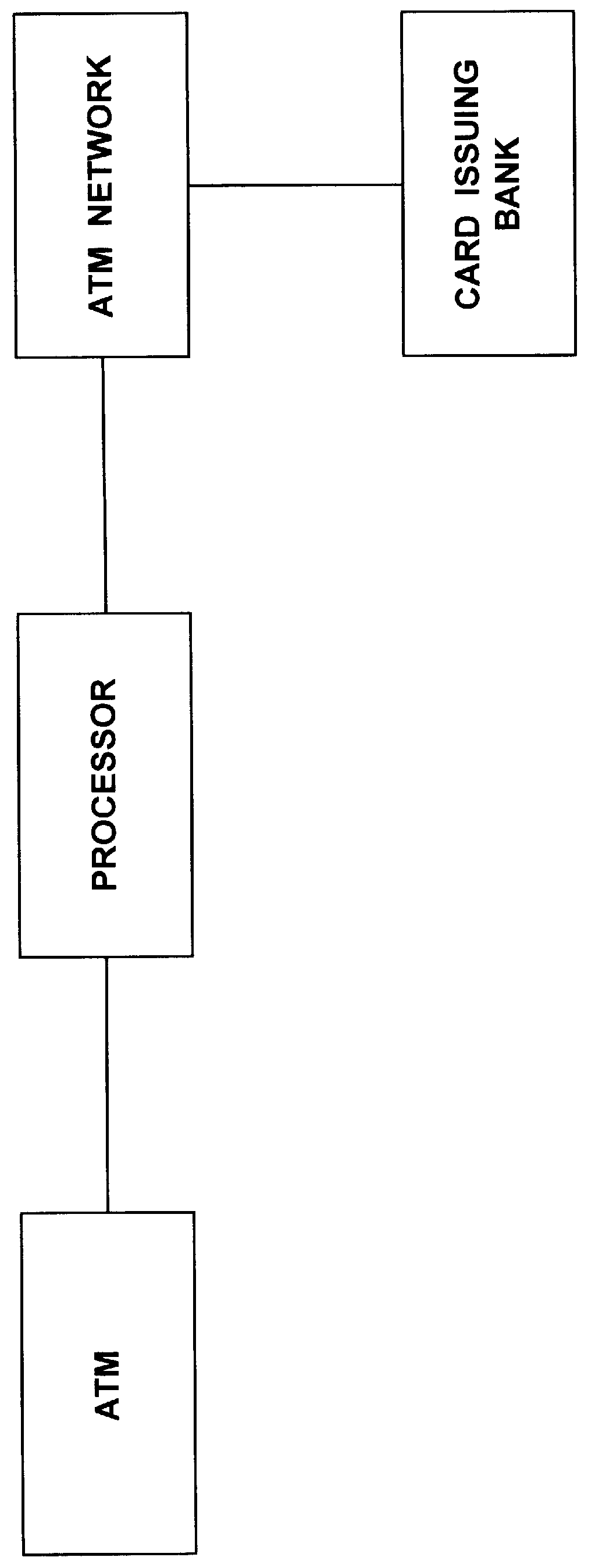

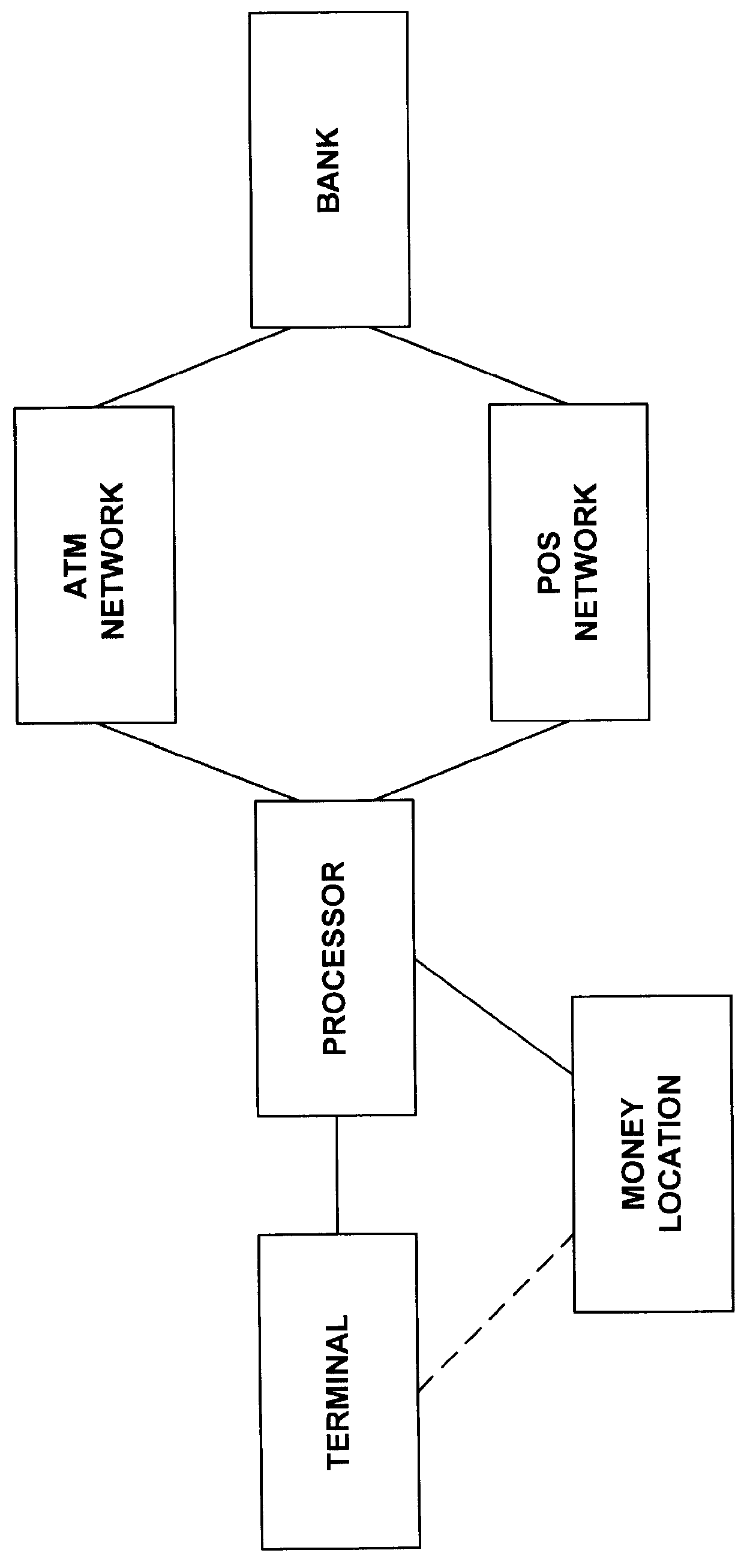

ATM and POS terminal and method of use thereof

A method of providing money, goods, services or the like to an account-holder based on an account when the daily ATM limit set by a bank has been met, or when a debit or credit card PIN cannot be remembered. The process will enable one to access cash and items of value through either the ATM network or a point-of-sale network to thereby obtain cash or an item of value. If the account-holder has exceeded the ATM network limit, a processor may prompt the account-holder to determine if the account-holder would like to access the account through the point-of-sale network. The money or item of value will be disbursed to the account-holder at a third location, where precautionary security measures may be utilized to ensure that the person receiving the cash is indeed the proper account-holder.

Owner:EVERI PAYMENTS

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com