Patents

Literature

681results about "ATM depositing" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

Wireless electronic check deposit scanning and cashing machine with web-based online account cash management computer application system

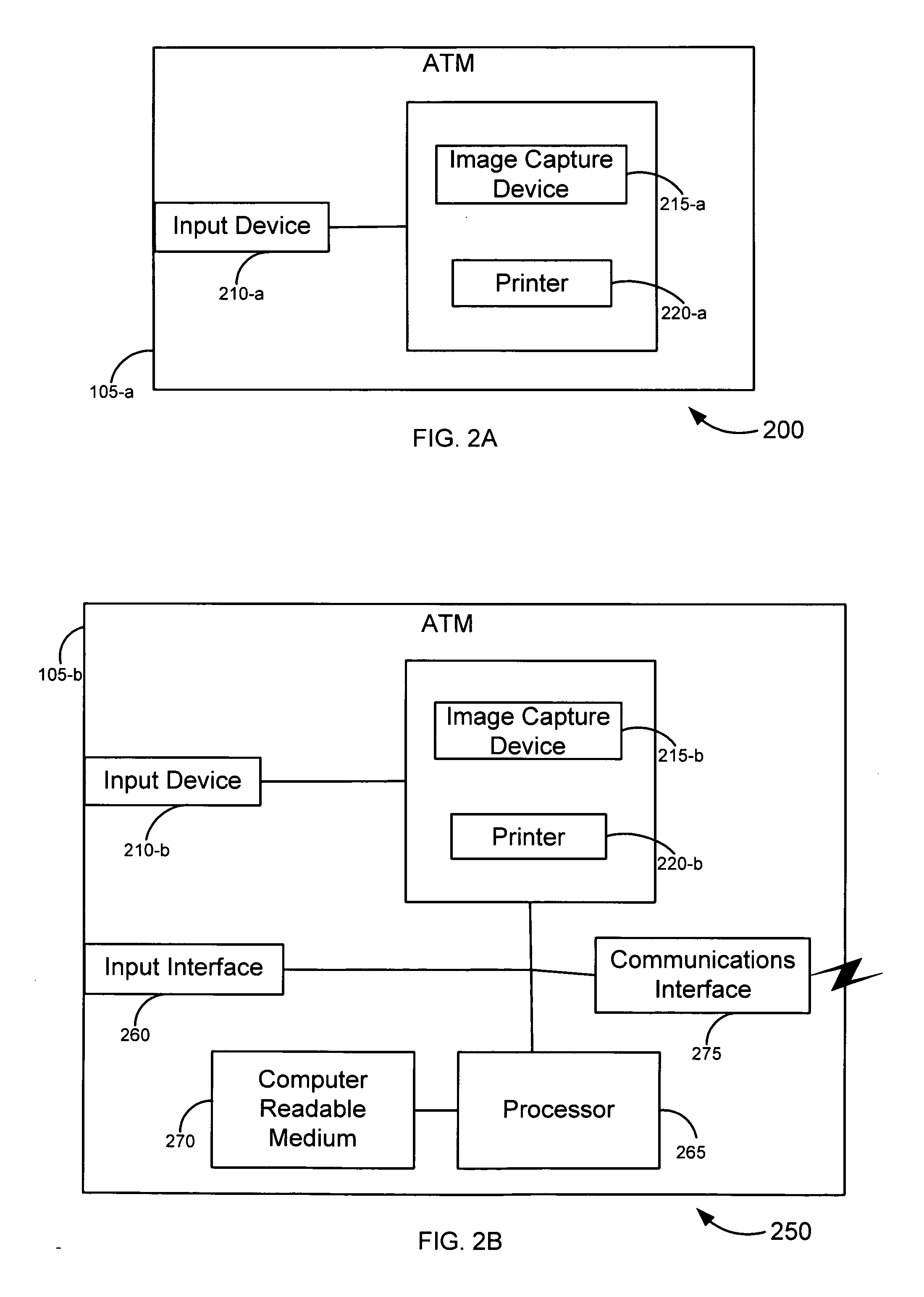

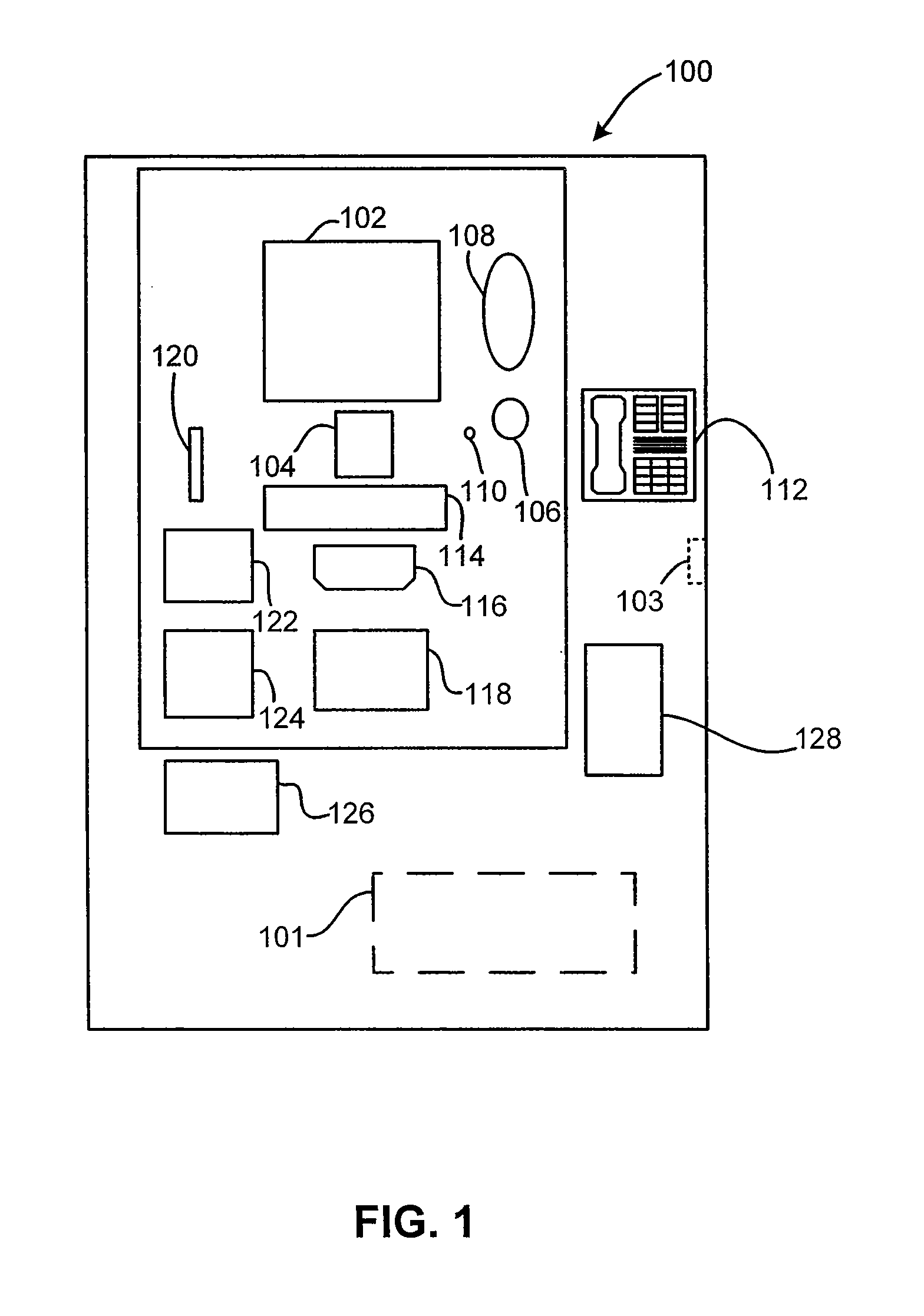

Wireless Electronic Check Deposit Scanning and Cashing Machine (also known and referred to as WEDS) Web-based Online account cash Management computer application System (also known and referred to as OMS virtual / live teller)—collectively invented integrated as “WEDS.OMS” System. Method and Apparatus for Depositing and Cashing Ordinary paper and / or substitute checks and money orders online Wirelessly from home / office computer, laptop, Internet enabled mobile phone, pda (personal digital assistant) and / or any Internet enabled device. WEDS enables verification and transmittal of image, OMS is the navigation tool used to set commands and process requests, integrated with WEDS, working collectively as WEDS.OMS System.

Owner:USAA

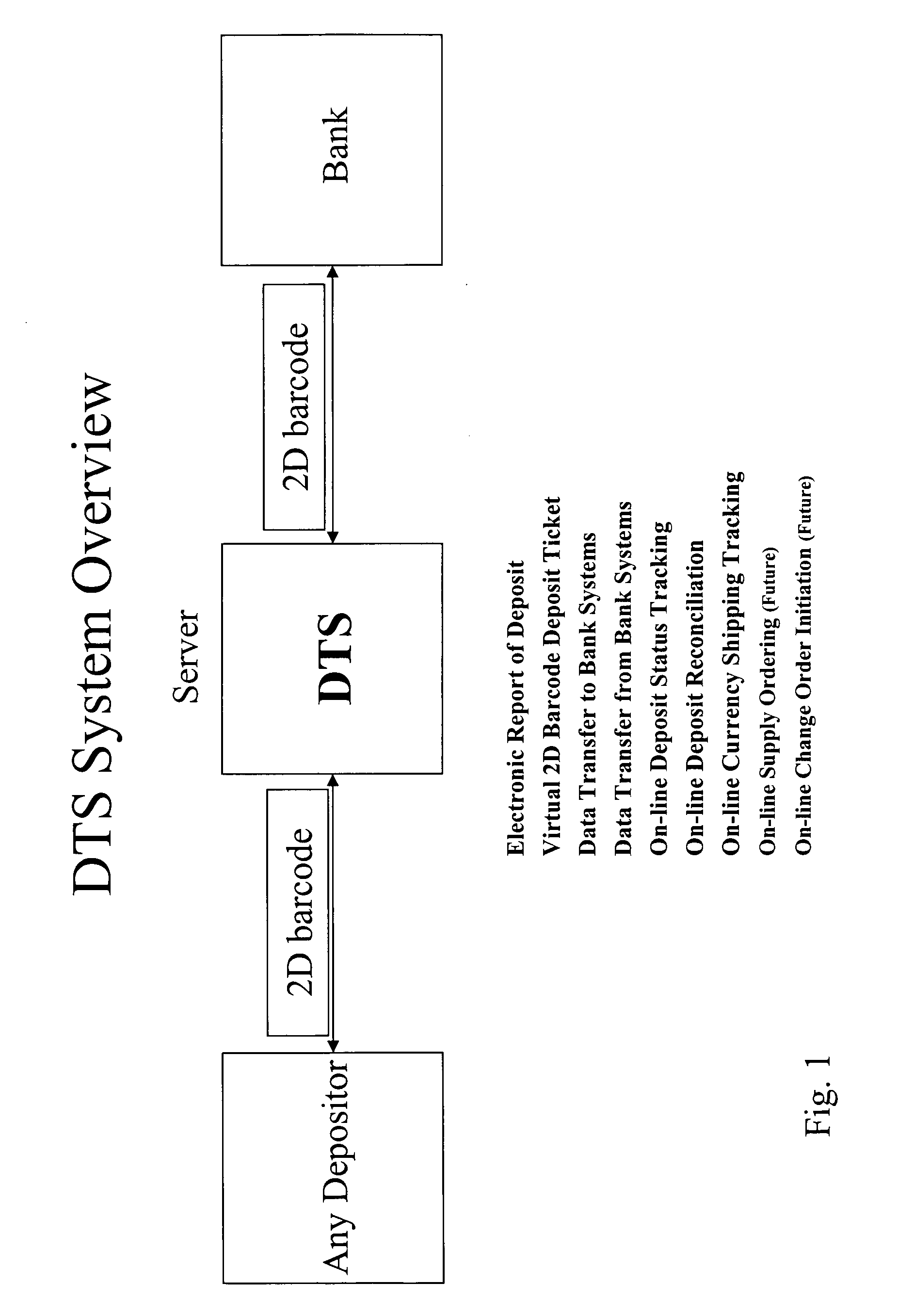

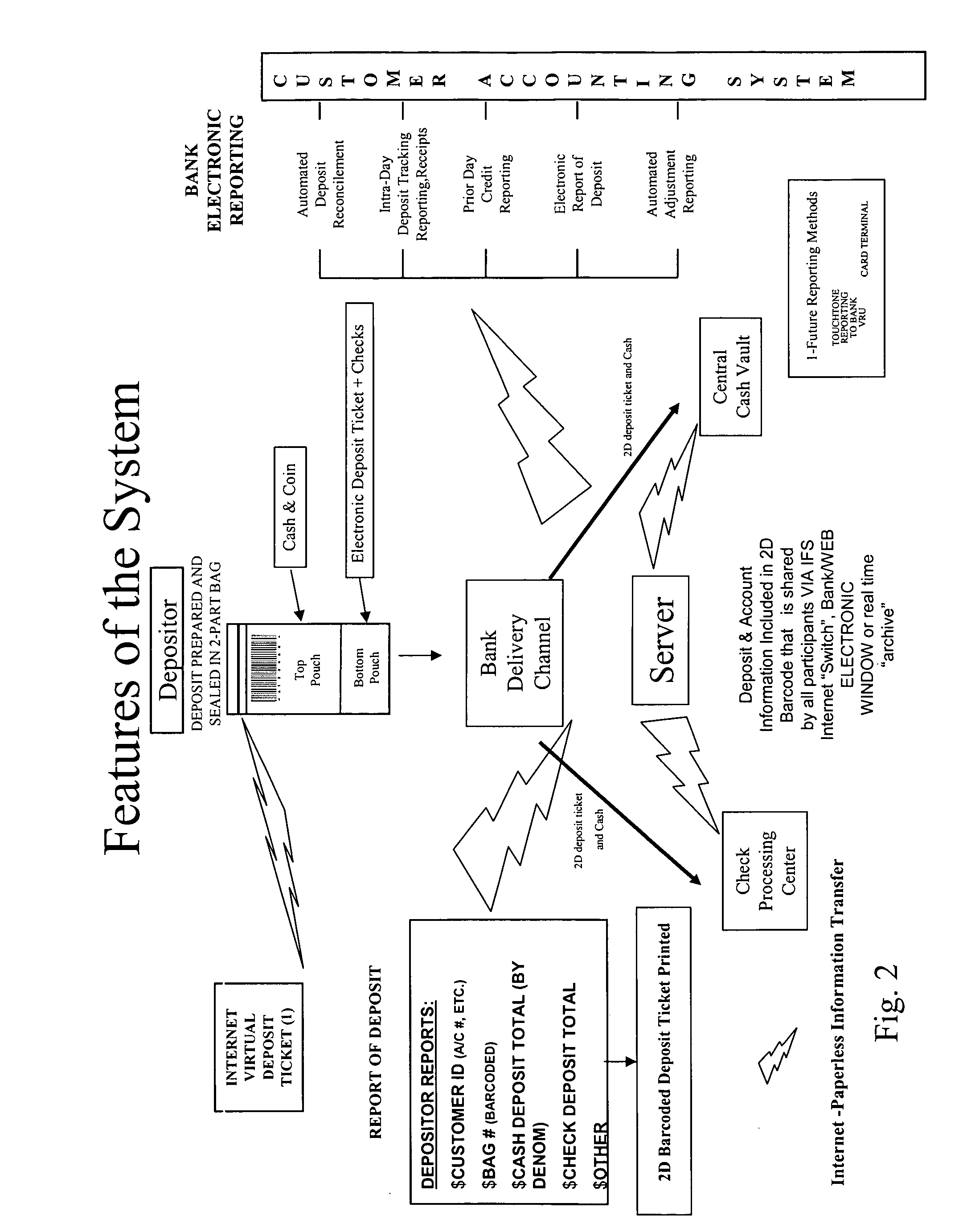

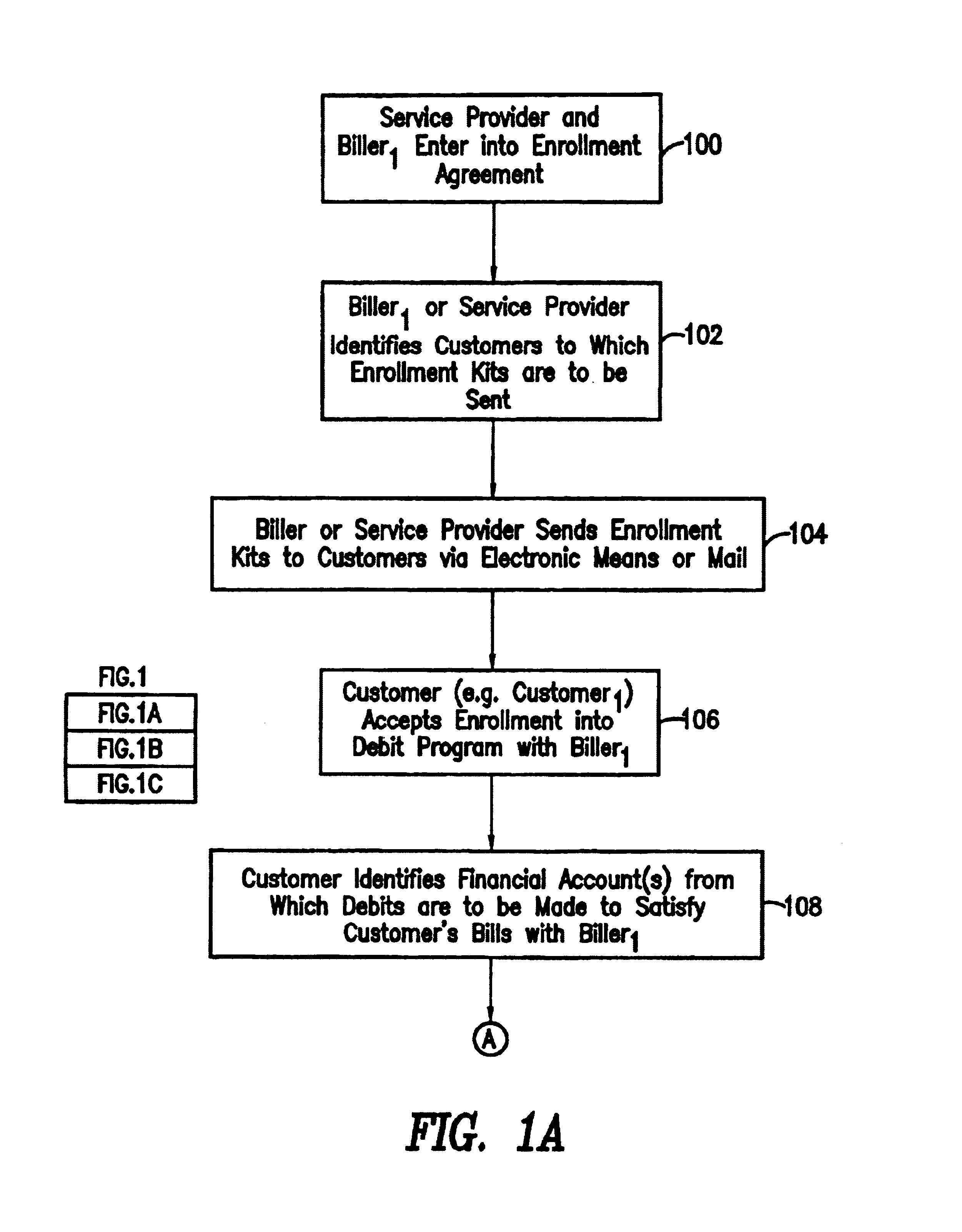

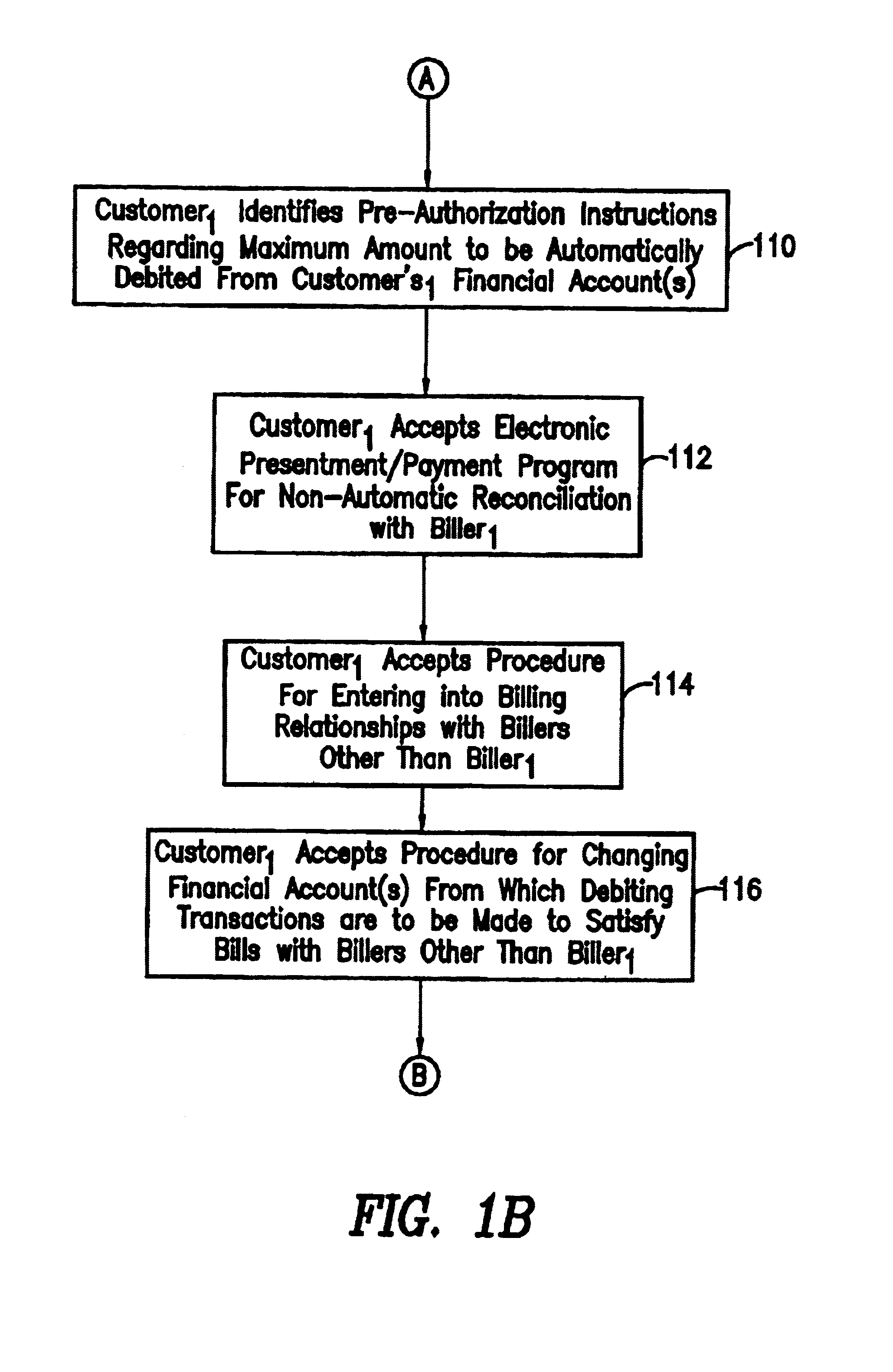

System and method to create electronic deposit records and to track the status of a deposit

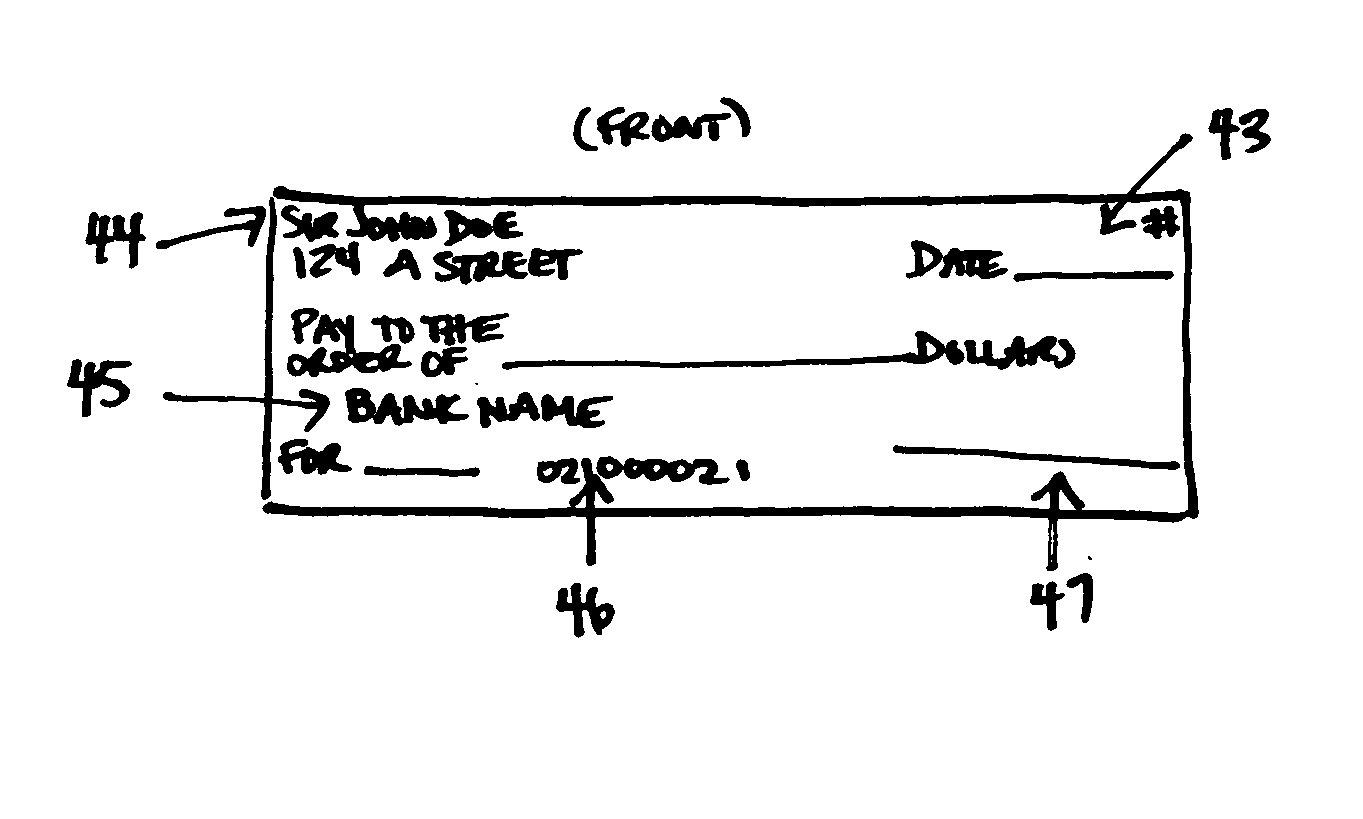

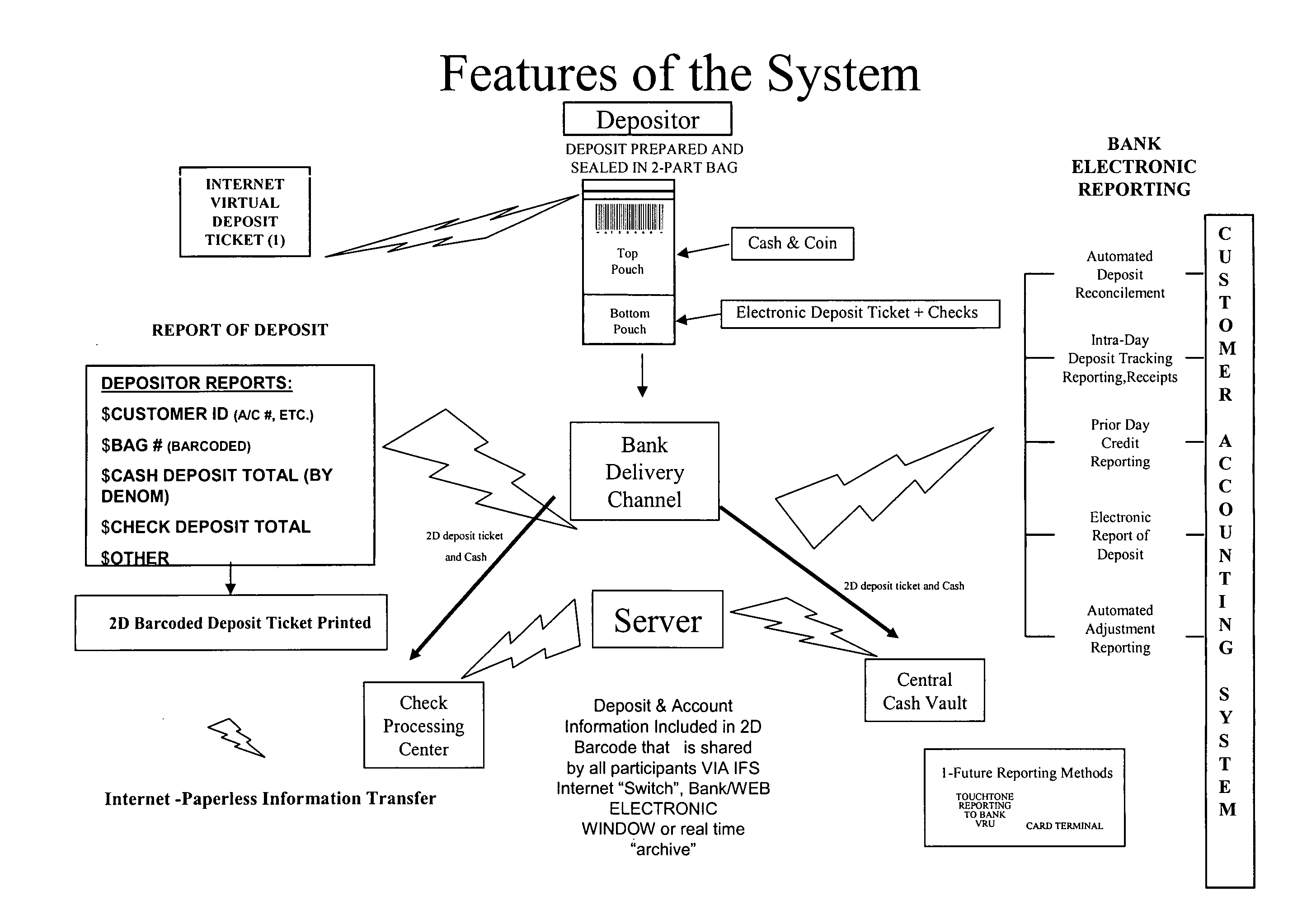

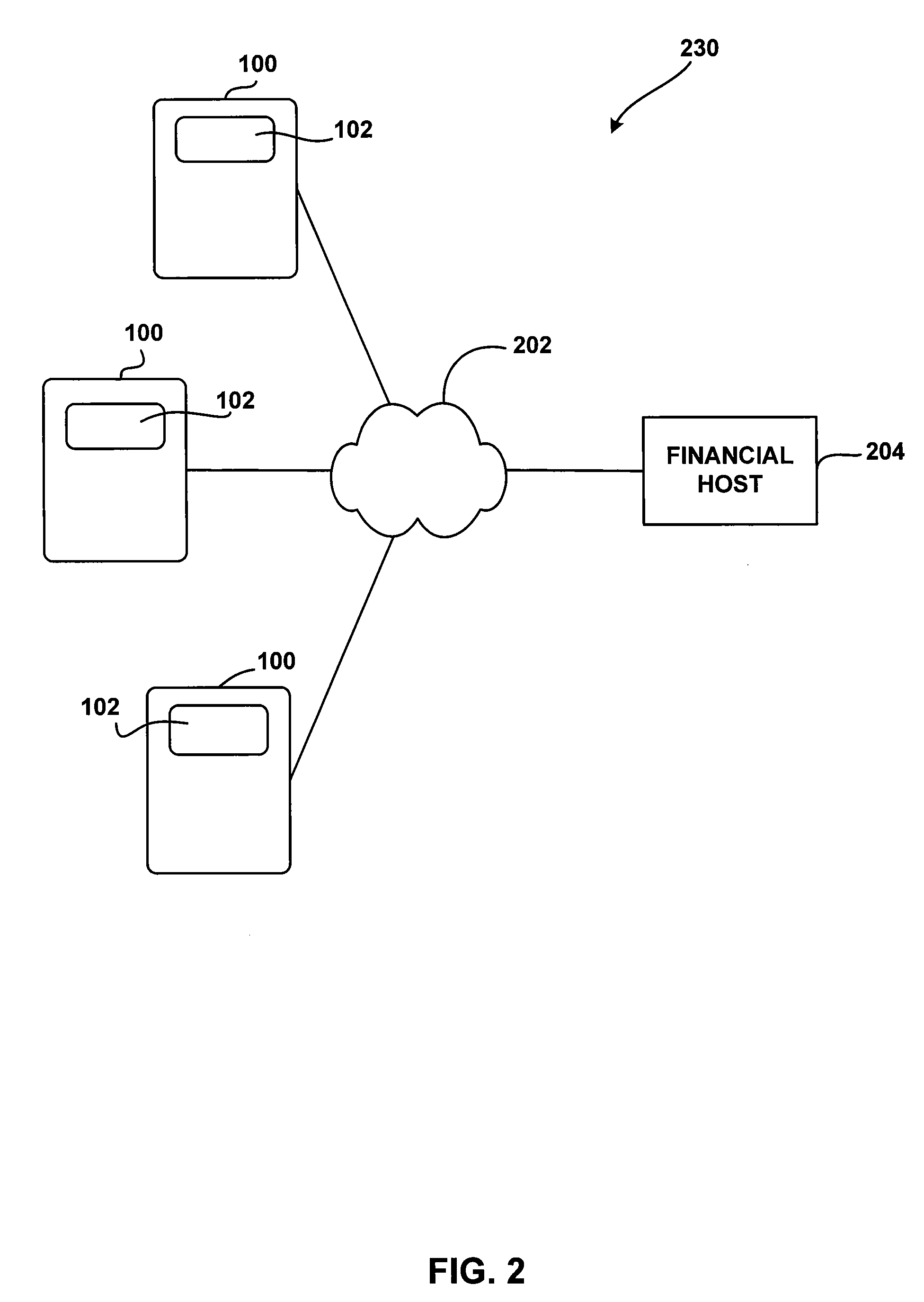

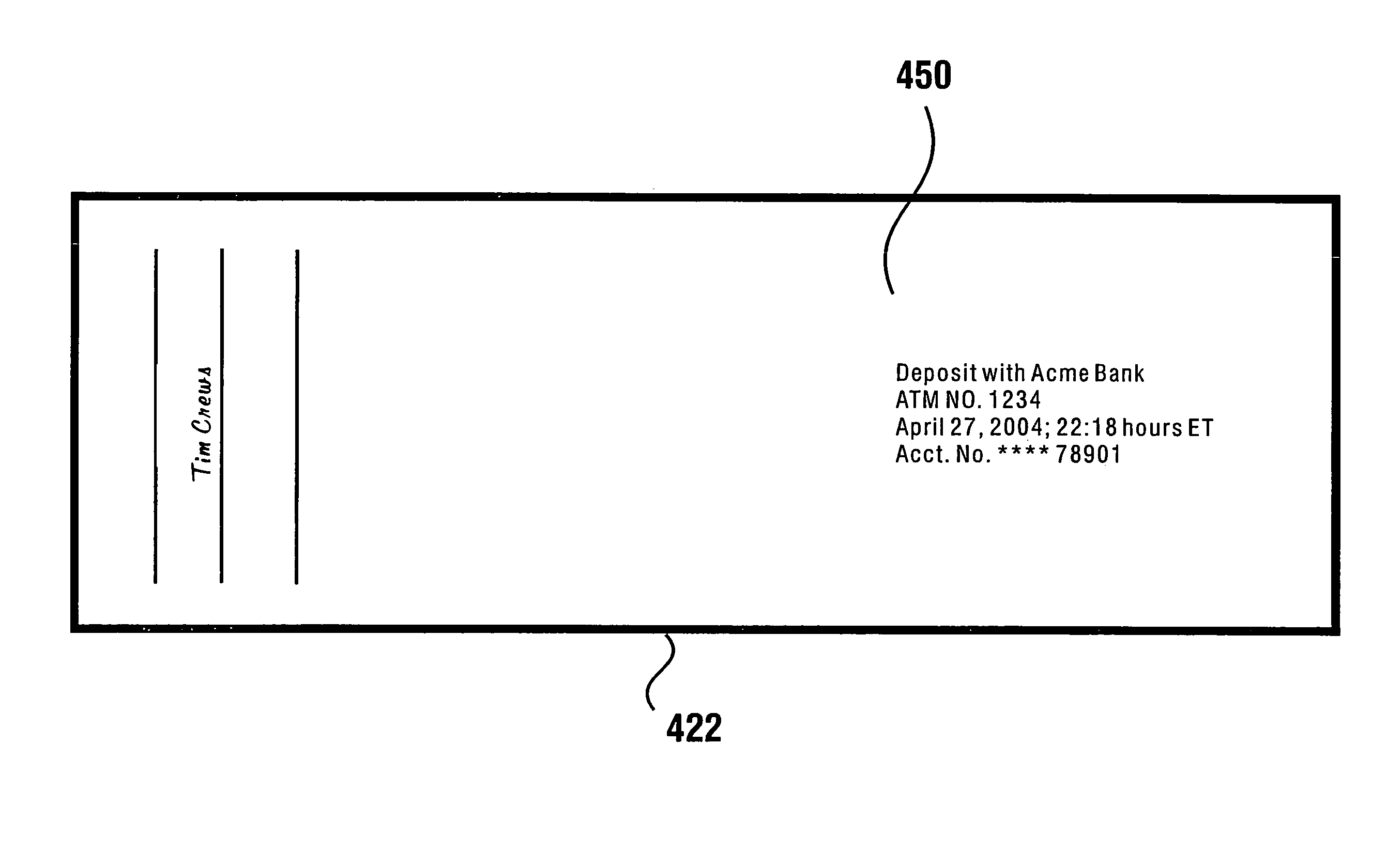

A method of making, tracking and confirming the receipt of bank deposits by a user to a financial institution is disclosed. The method includes first accessing a user account on a database, entering deposit information including the account number and amount of the intended deposit on the database to create an electronic deposit record, and then encoding the deposit information in a machine readable format. The information is then associated with the encoded deposit information in close proximity with the deposit, creating a deposit package. The package is then transmitted to a financial institution or armored car carrier where the machine readable encoded deposit information is read and transmitted to a database that contains information about the account and status of the deposit.

Owner:INT FINANCIAL SERVICES

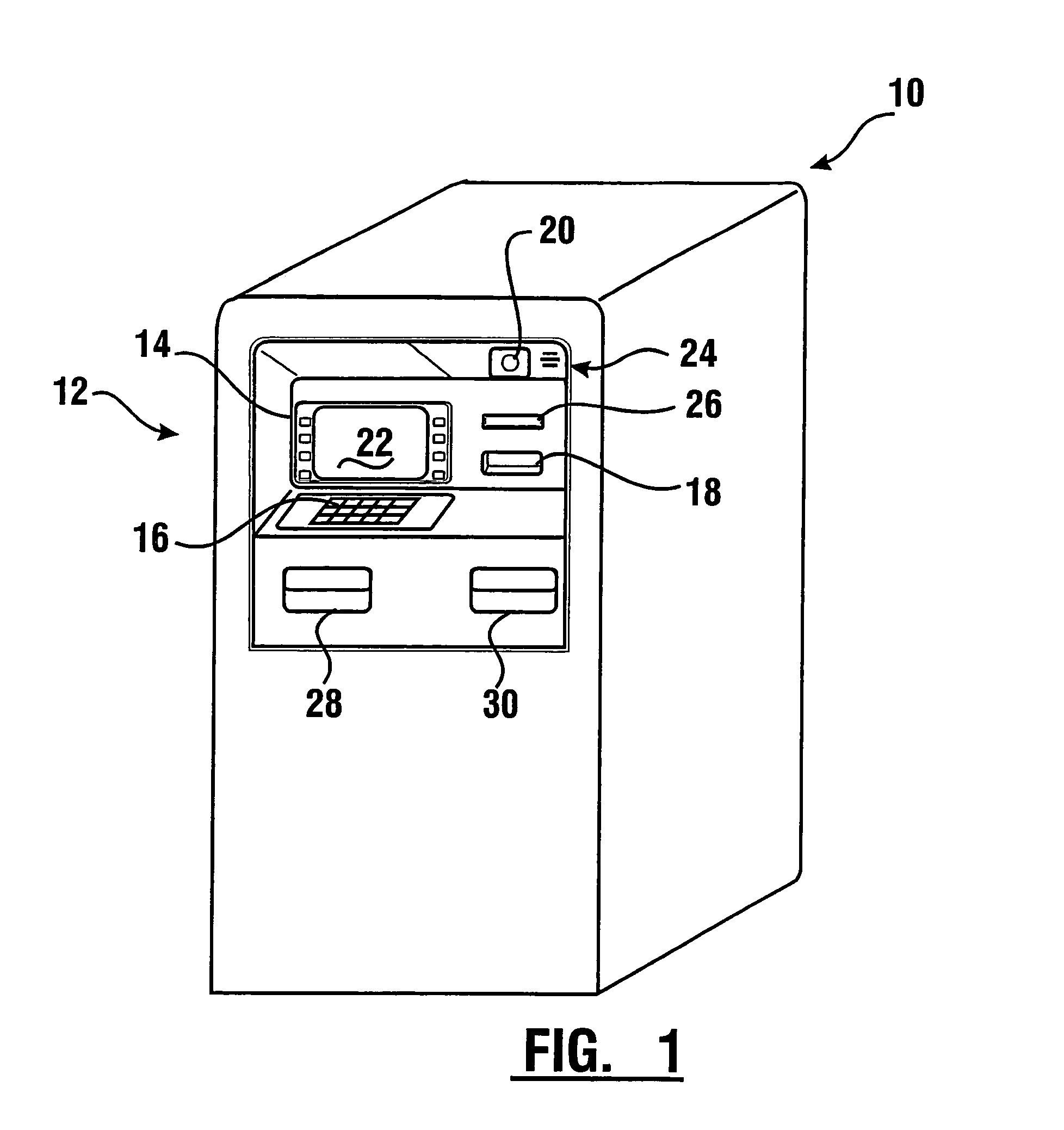

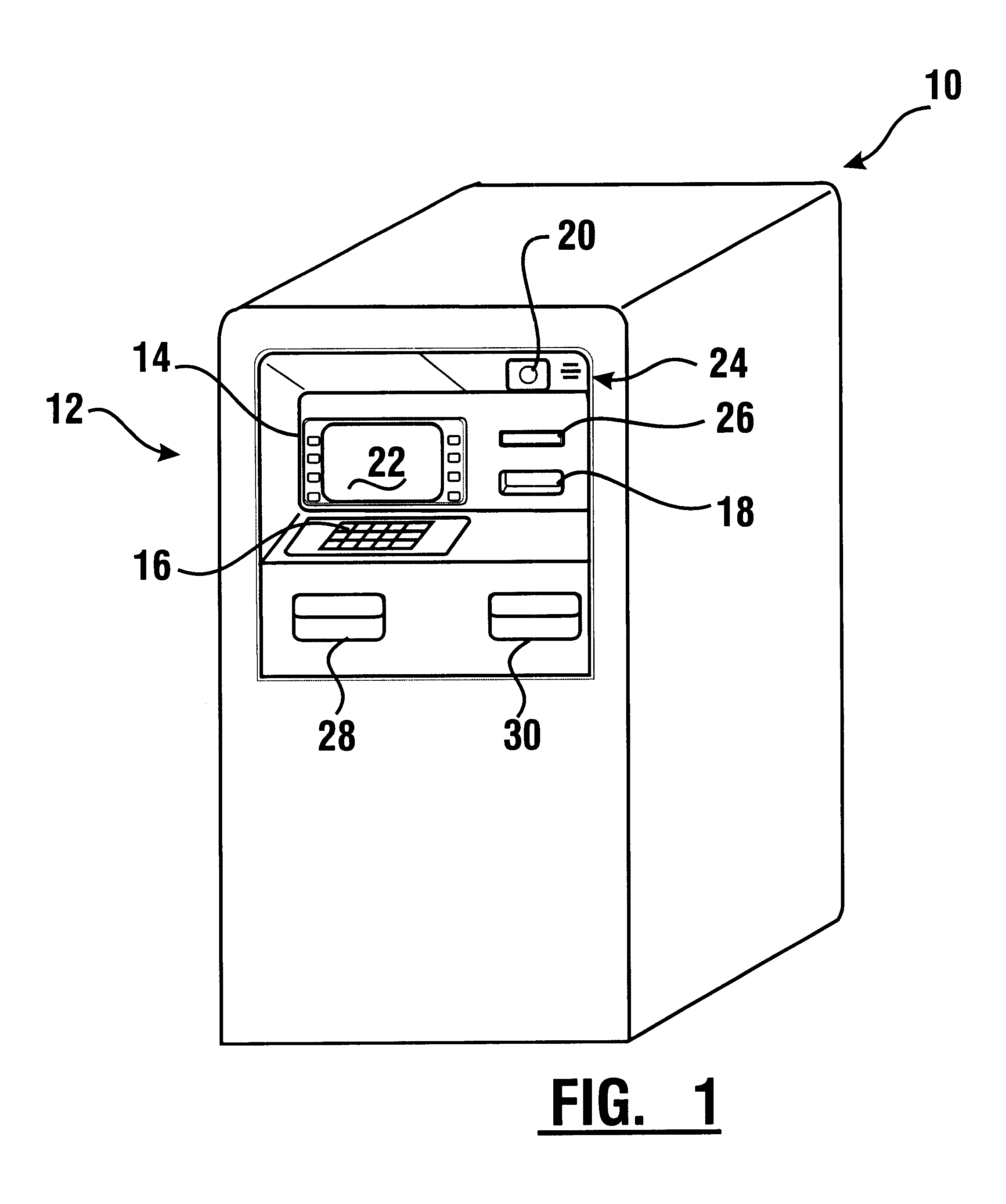

Automated banking apparatus and method

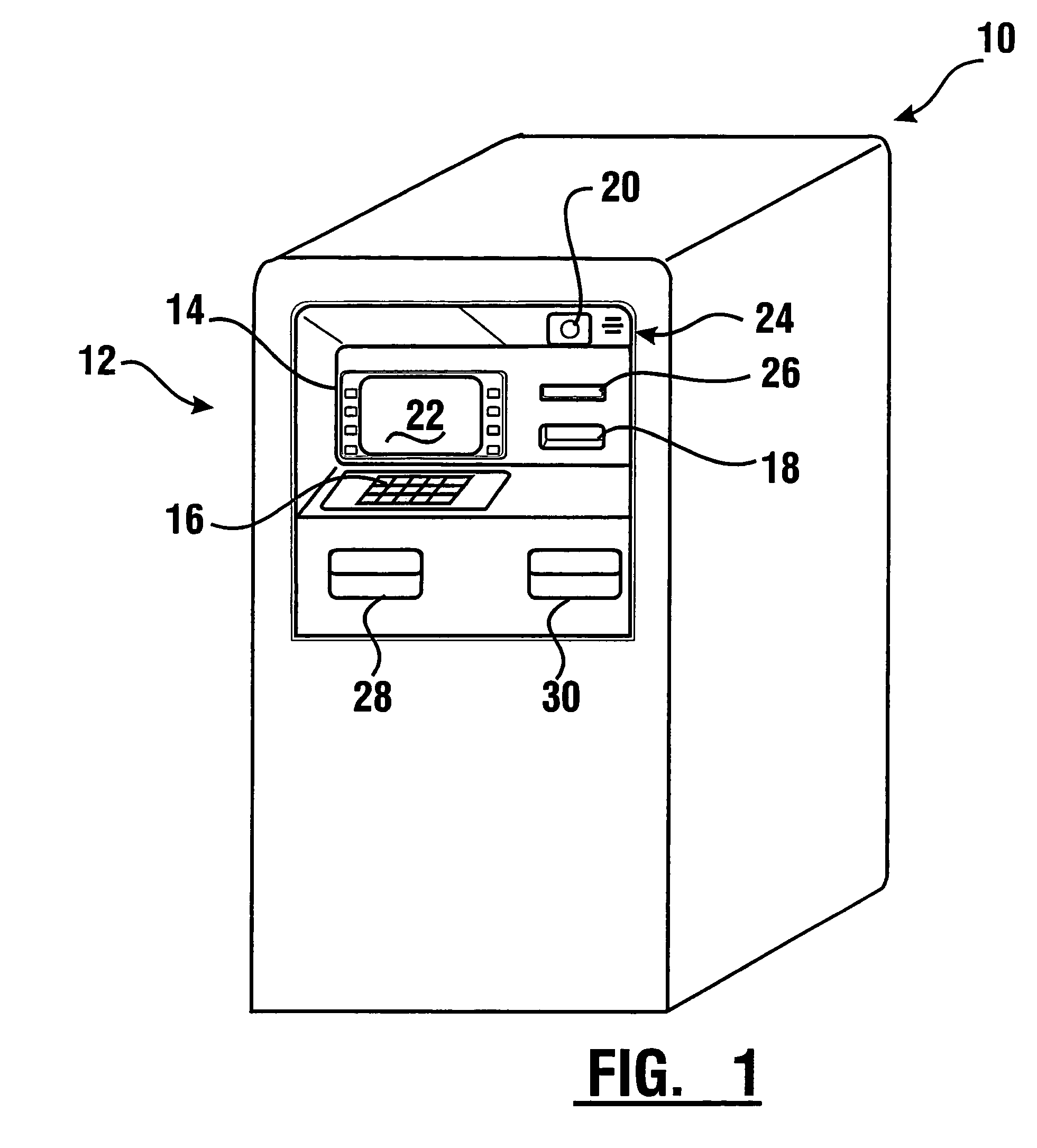

InactiveUS20040016796A1Accurate specificationsGood user interfaceComplete banking machinesCoin/currency accepting devicesFinancial transactionCheque

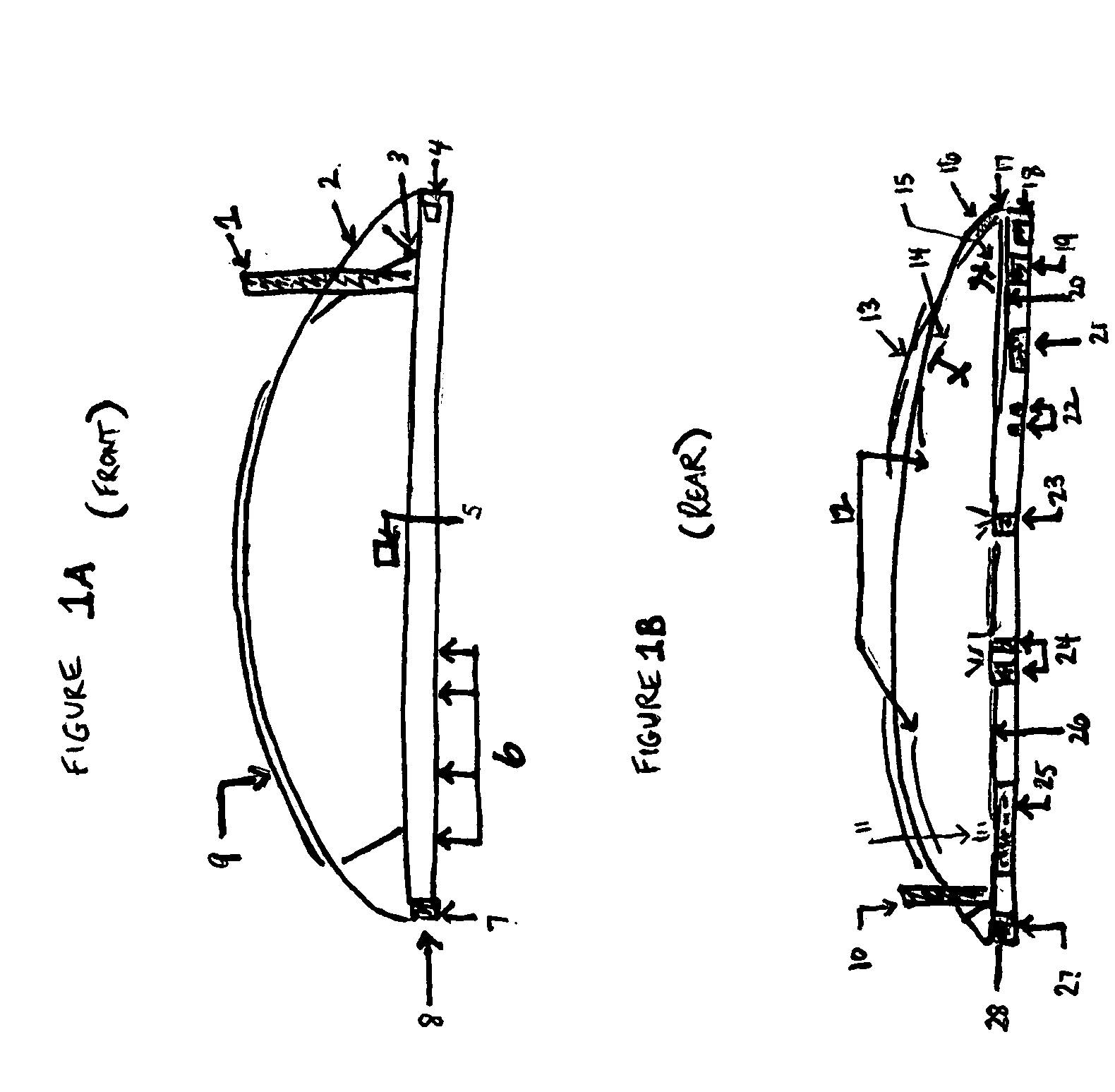

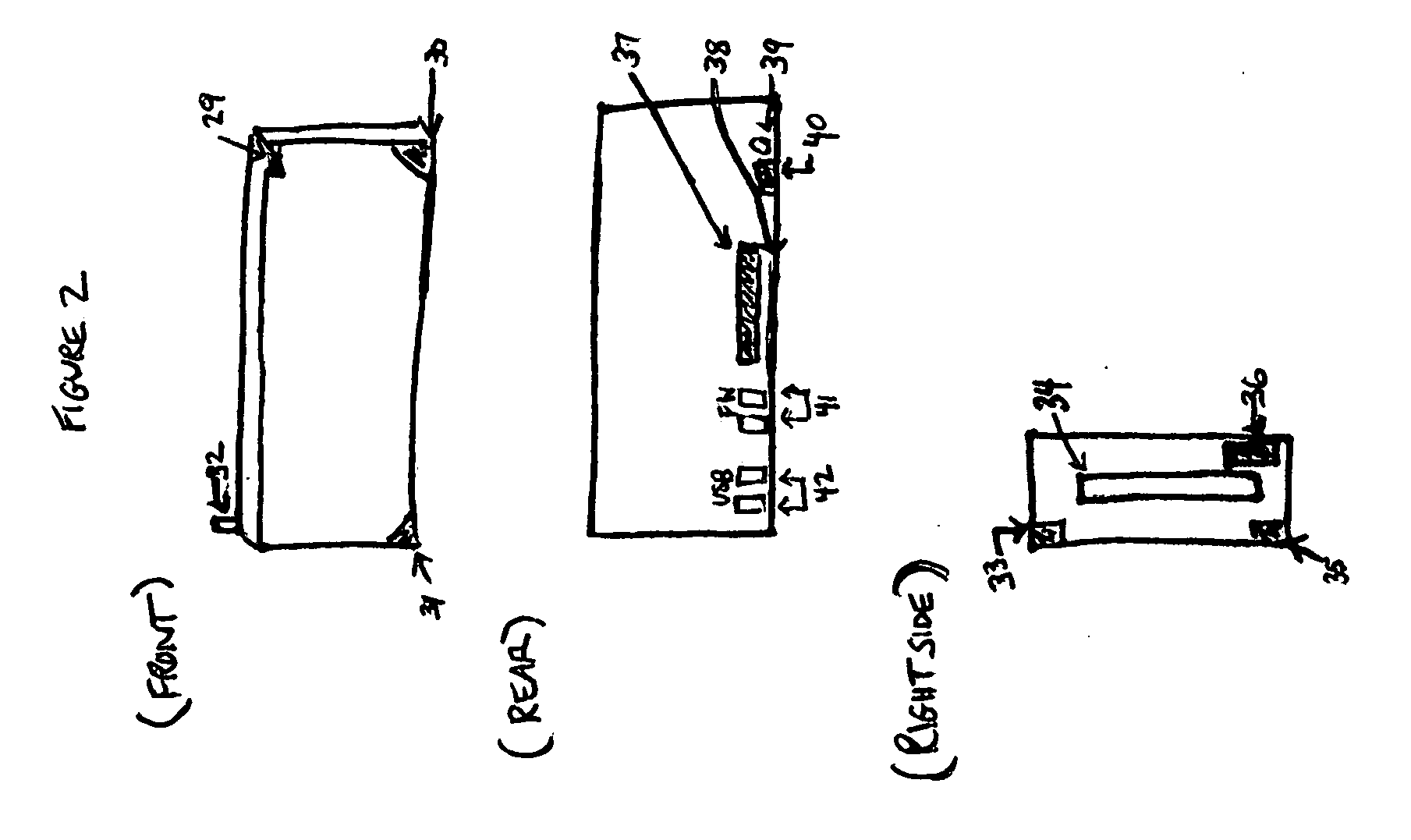

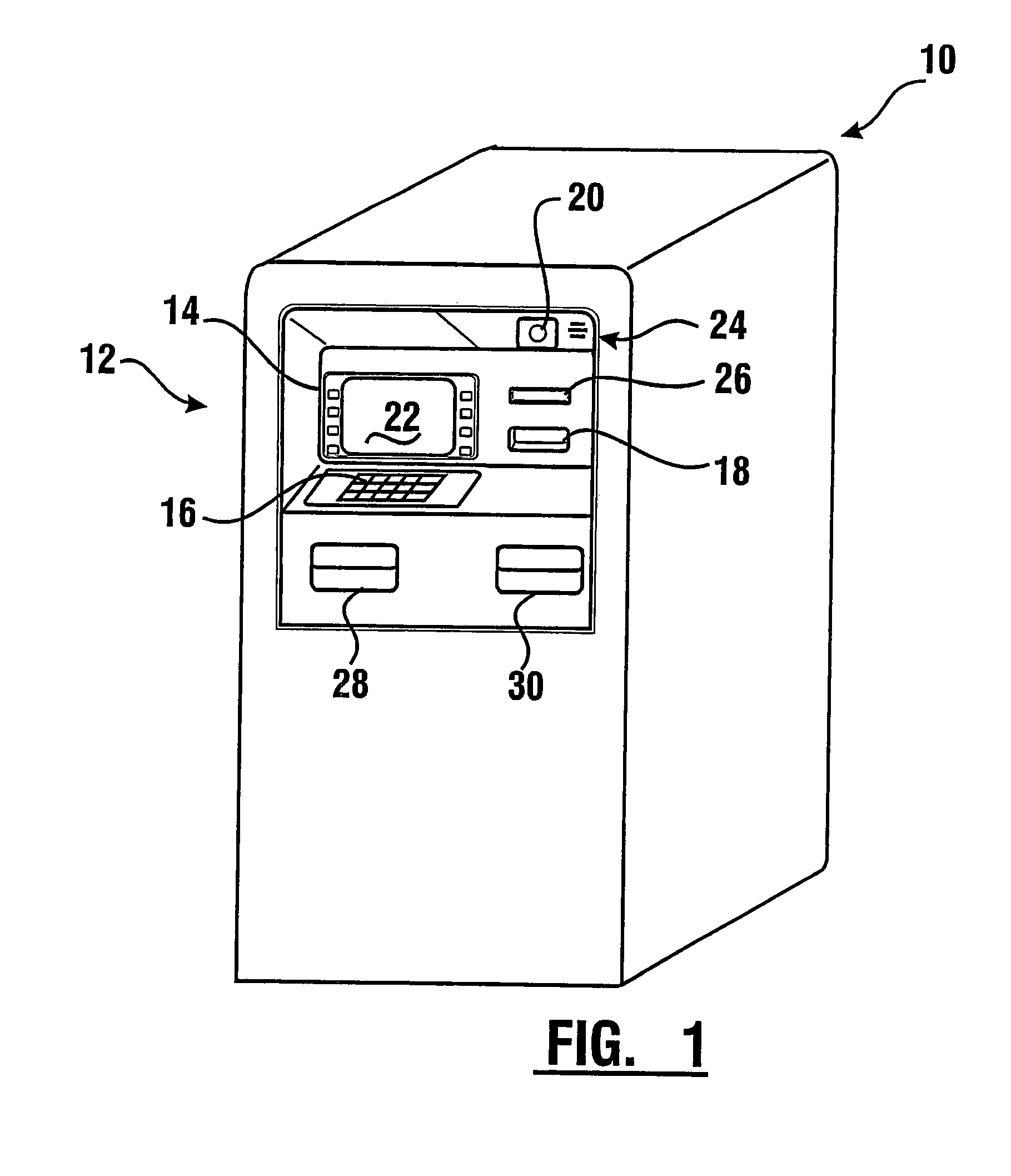

An automated banking apparatus is operative to carry out banking transactions commonly required by merchants. The apparatus includes an item accepting depository for accepting deposit items, such as deposit bags, currency, and checks. The apparatus further includes an input device that is operative to interrogate an RFID tag to obtain merchant deposit information therefrom. The information can include data representative of the deposit, such as an account number and the deposit amount. The RFID tag may be located on an item being deposited.

Owner:DIEBOLD NIXDORF

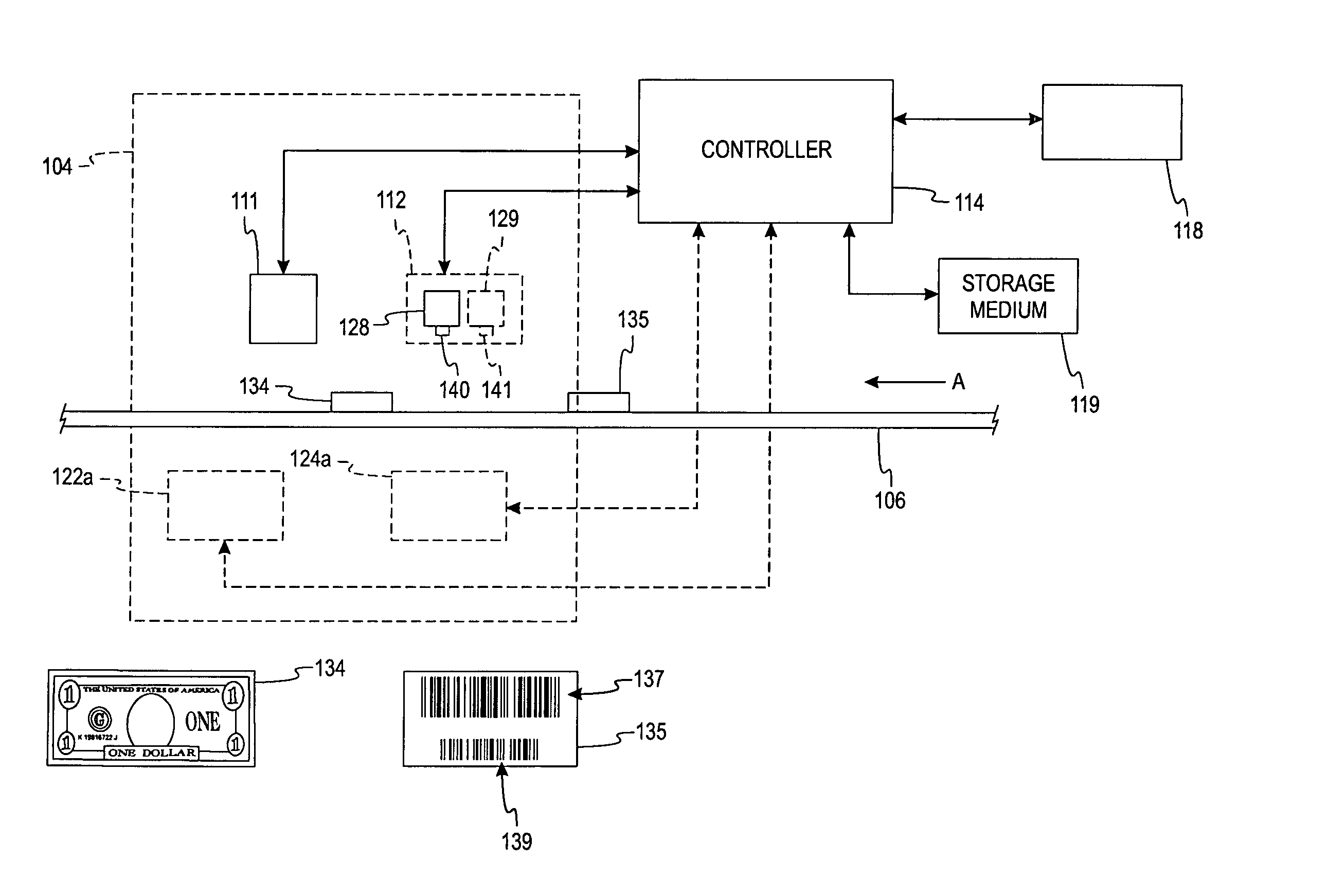

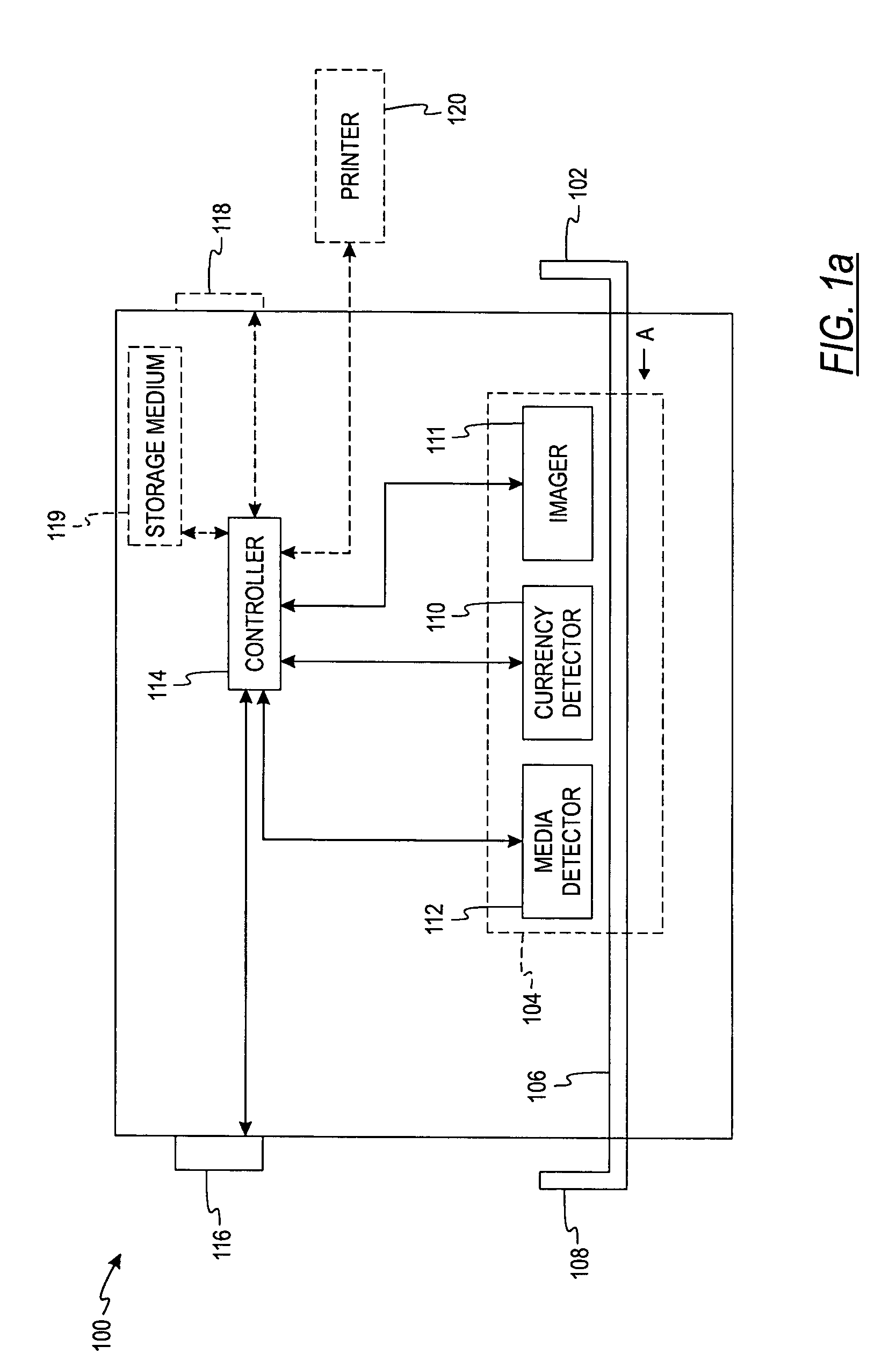

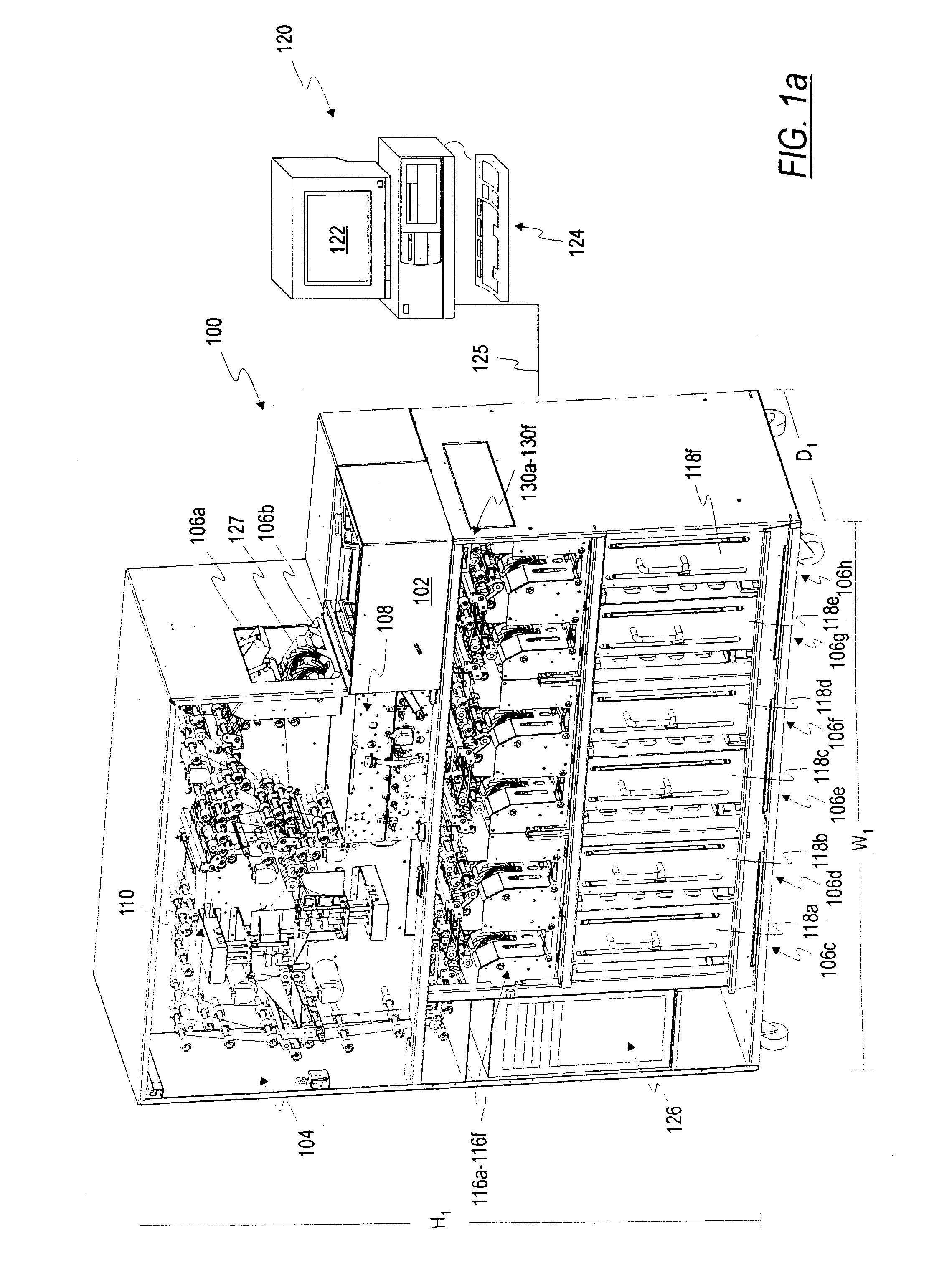

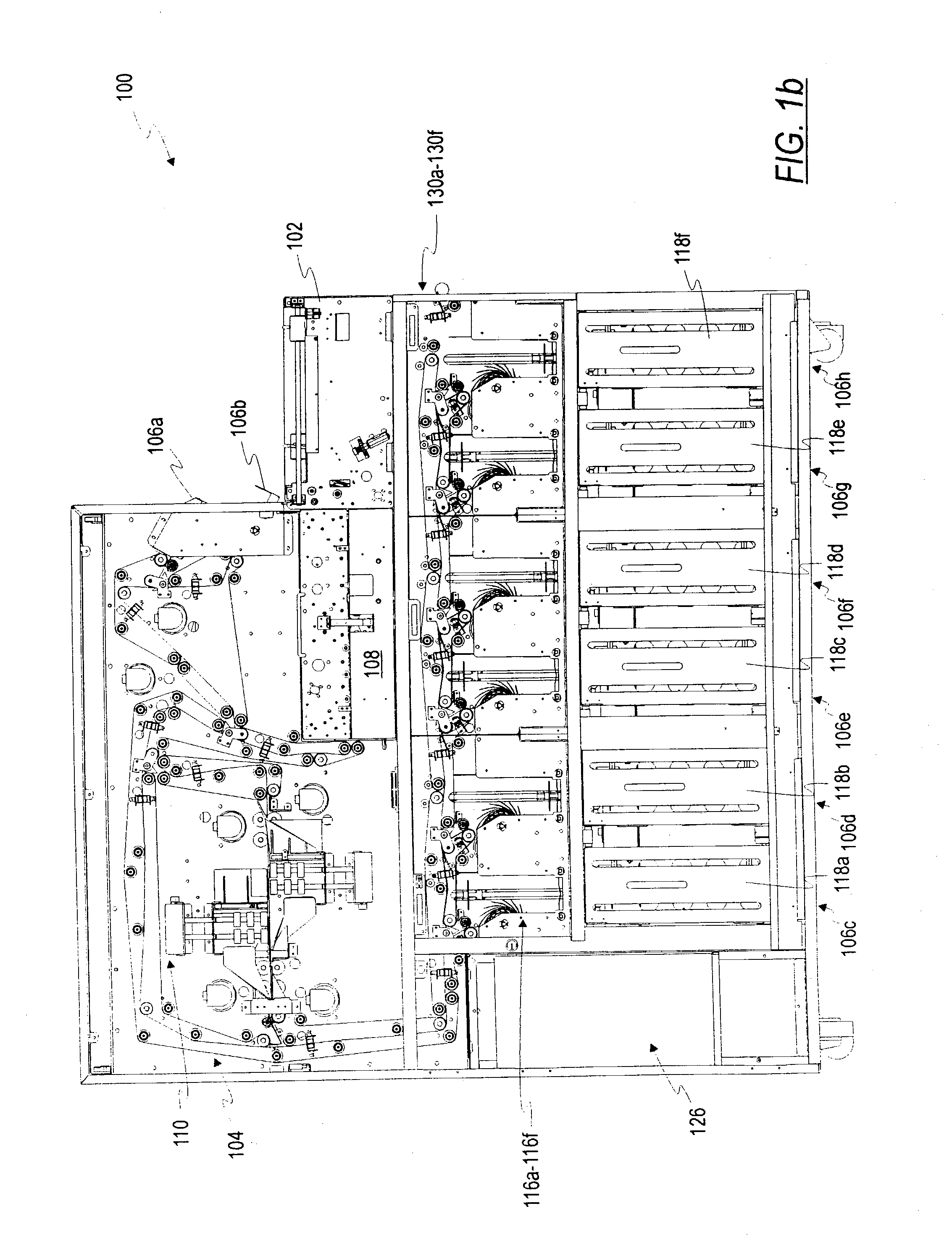

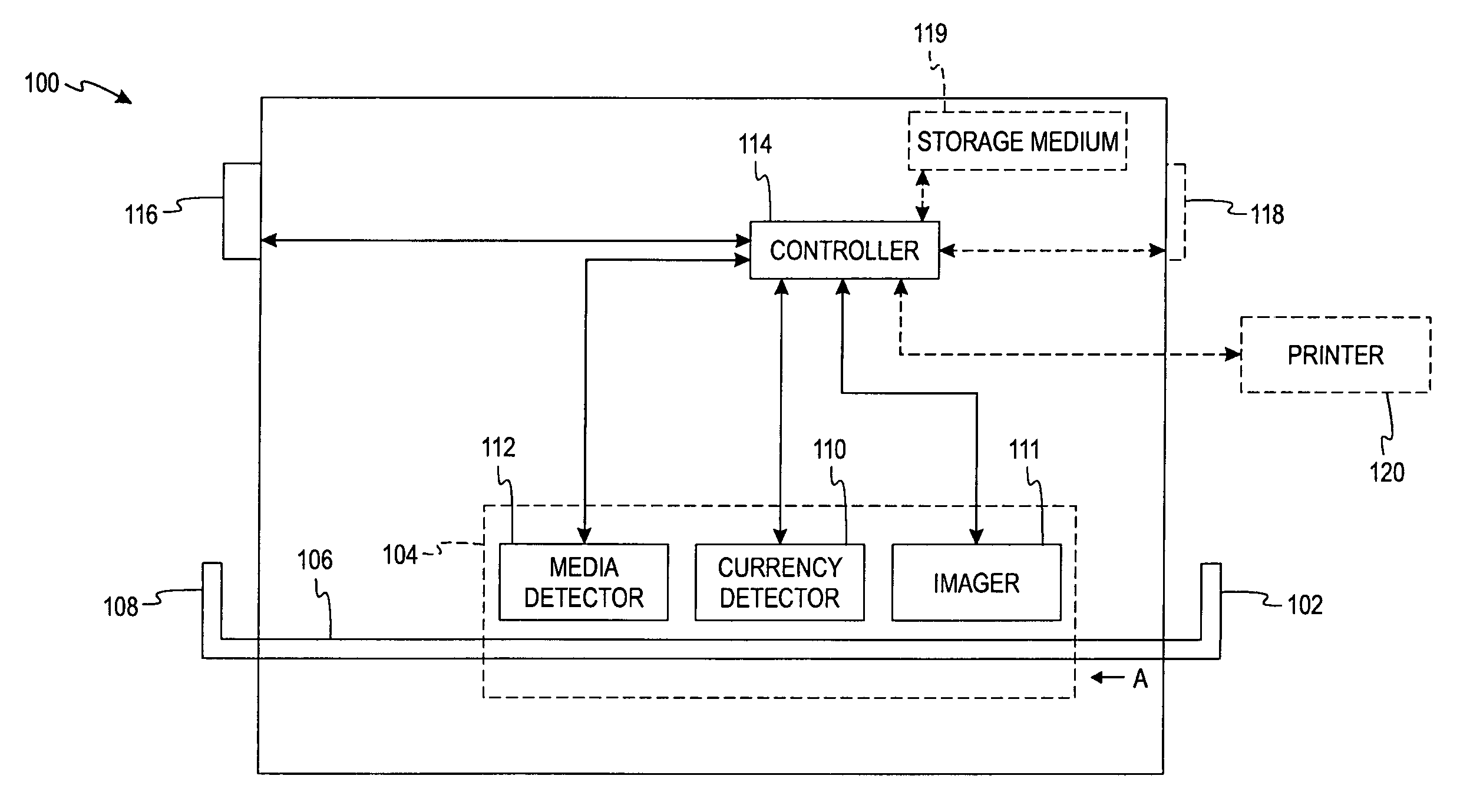

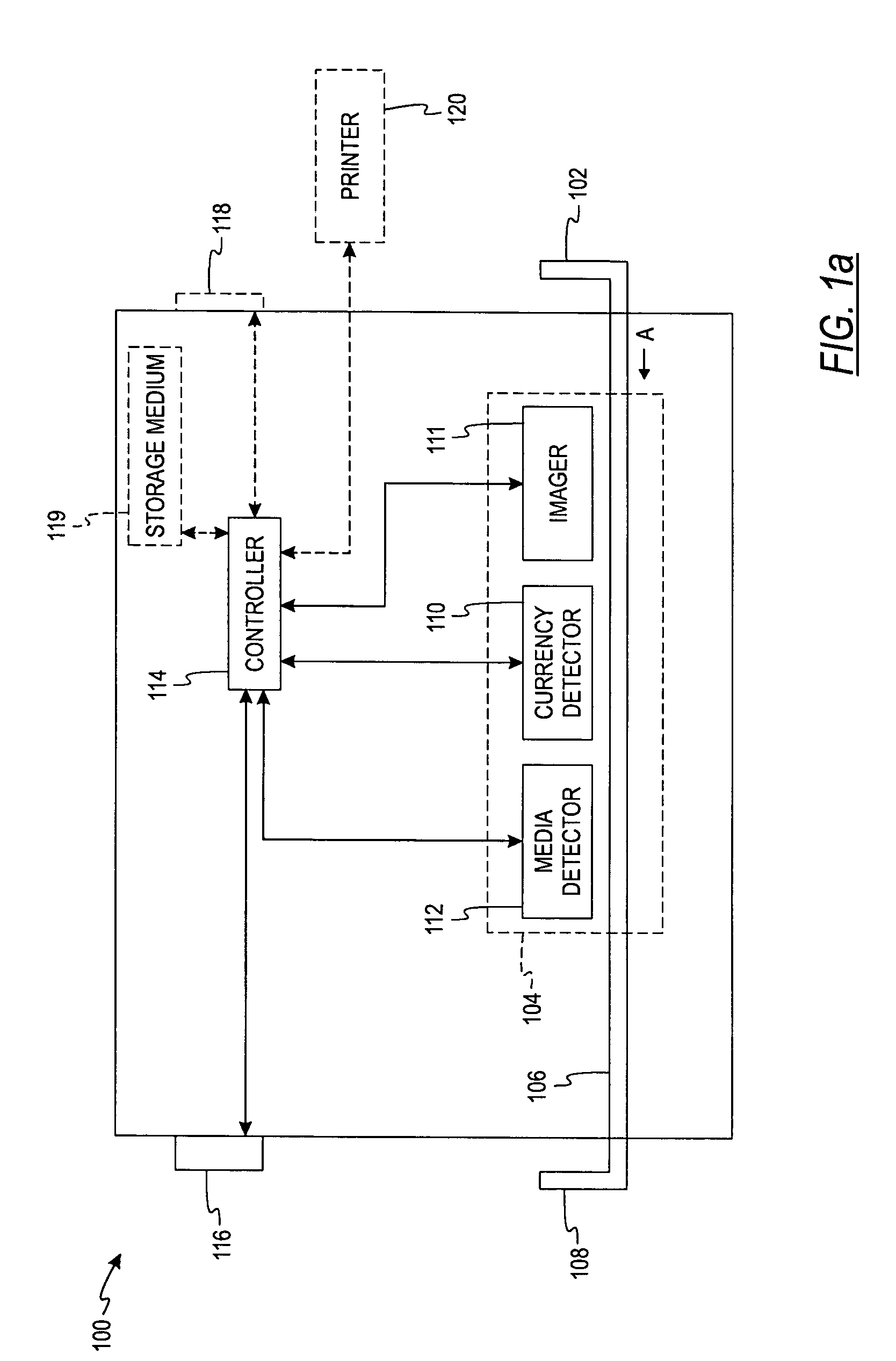

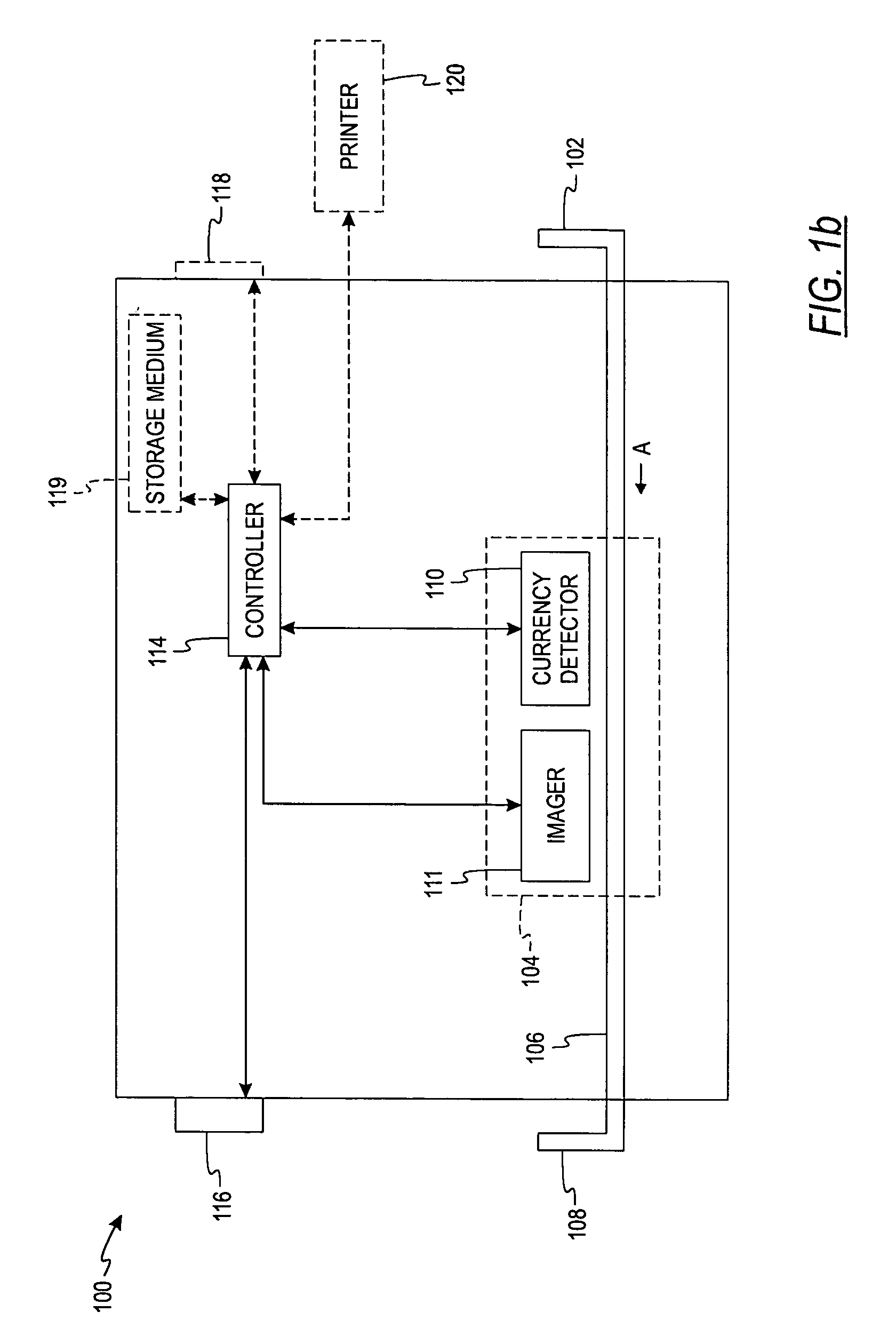

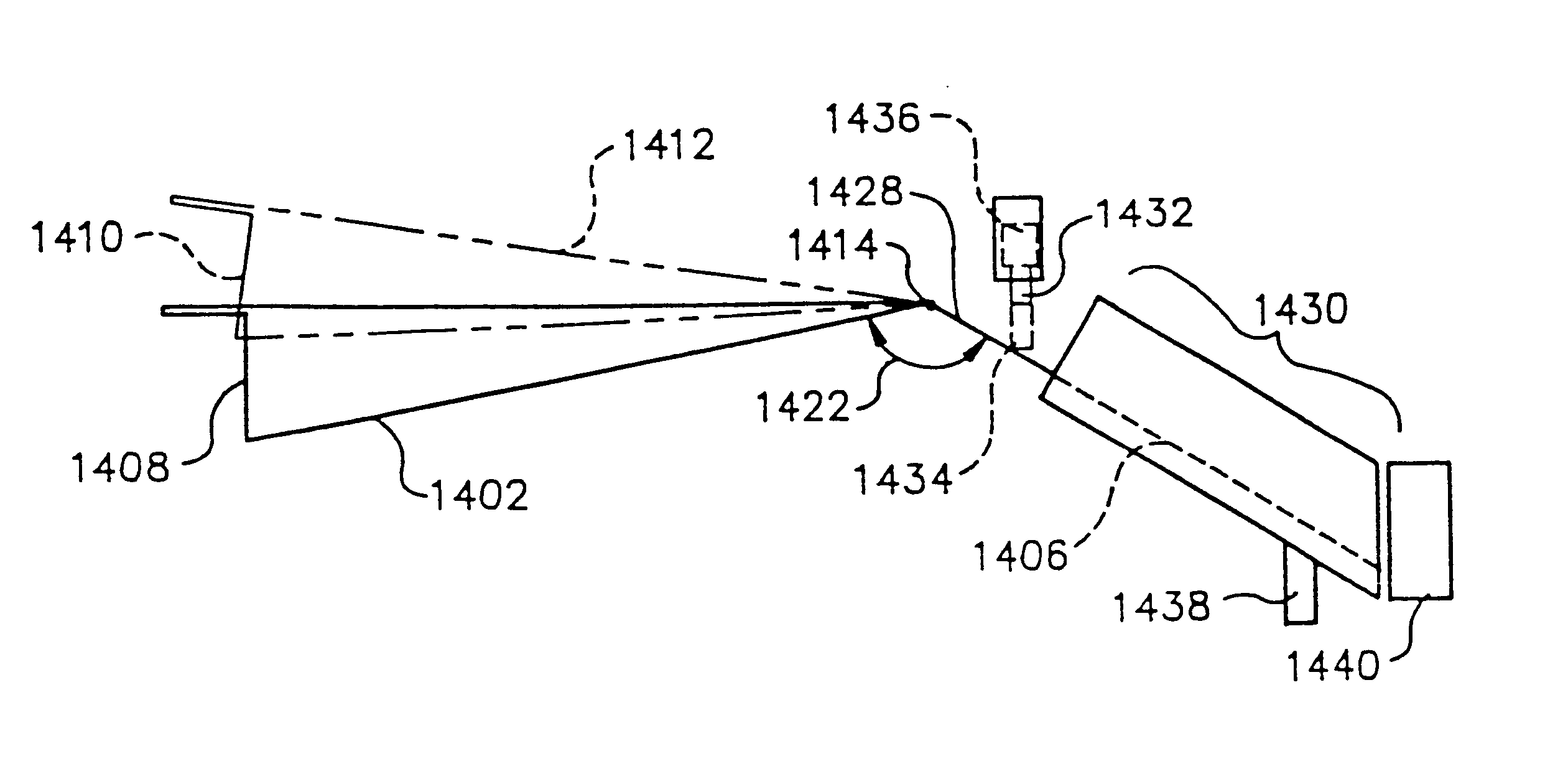

System and method for processing currency bills and documents bearing barcodes in a document processing device

A document processing device having an evaluation region disposed along a transport path between an input and output receptacle capable of processing both currency bills and substitute currency media having at least one indicia. The evaluation region includes at least one of a currency detector, a media detector, and an imager for detecting predetermined characteristics of currency bills and substitute currency media. A controller coupled to the evaluation region controls the operation of the document processing device and receives input from and provides information to a user via a control unit. In some embodiments, the document processing device may have any number of output receptacles, and the control unit allows the user to specify which output receptacle receives which type of document. An optional coin sorter may be coupled to the document processing device to allow document and coin processing. The document processing device may be coupled to a network to communicate information to devices linked to the network.

Owner:CUMMINS-ALLISON CORP

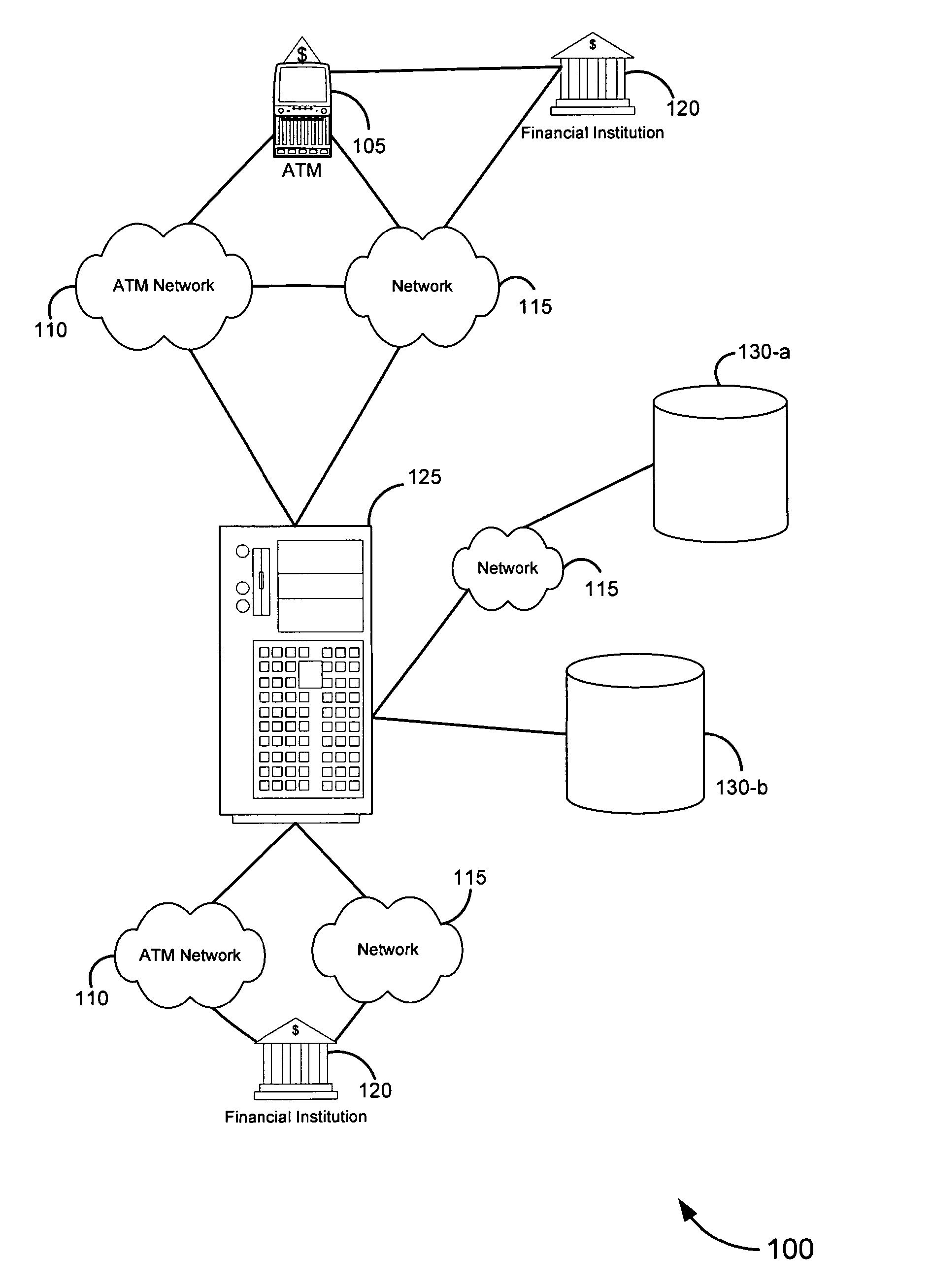

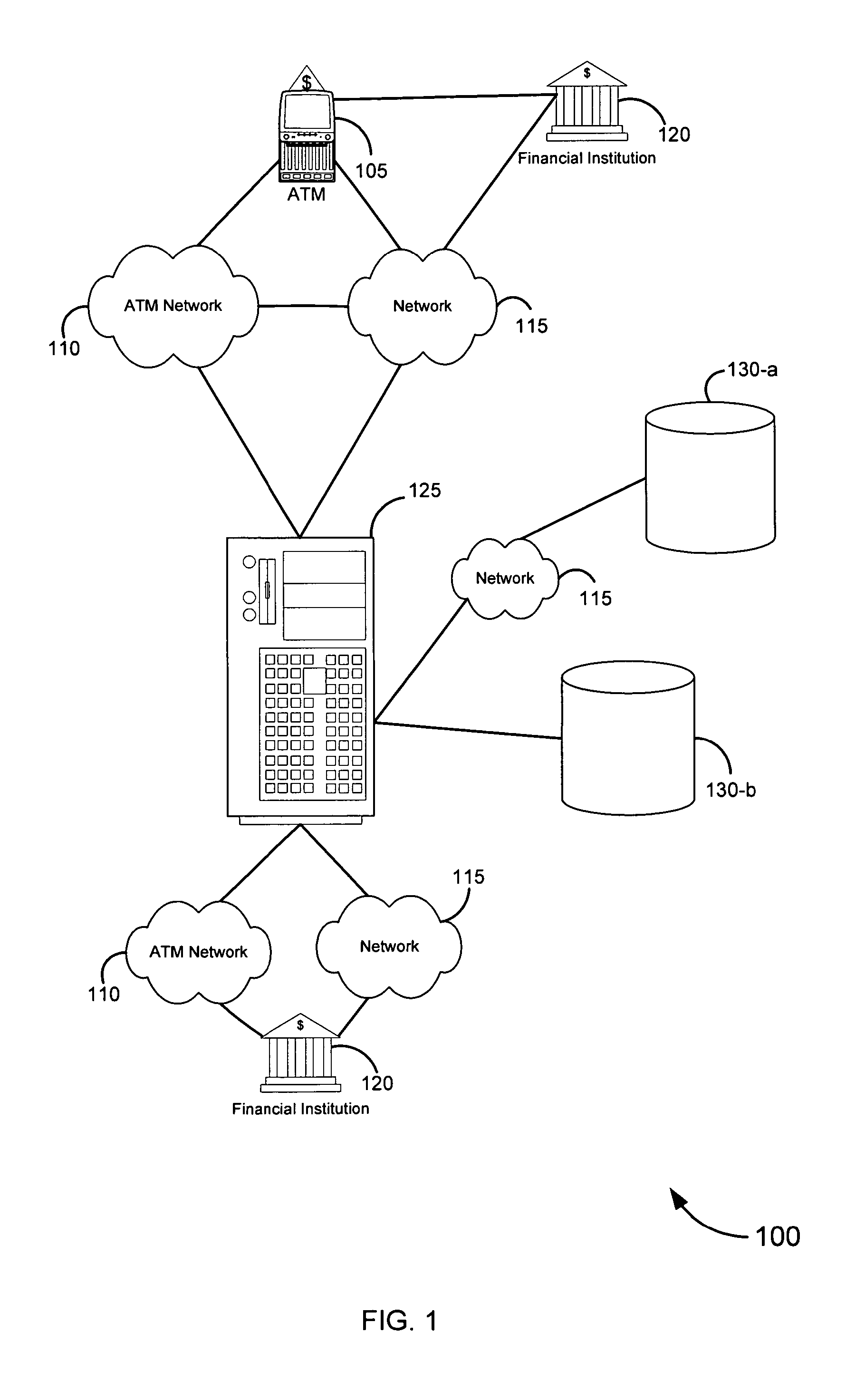

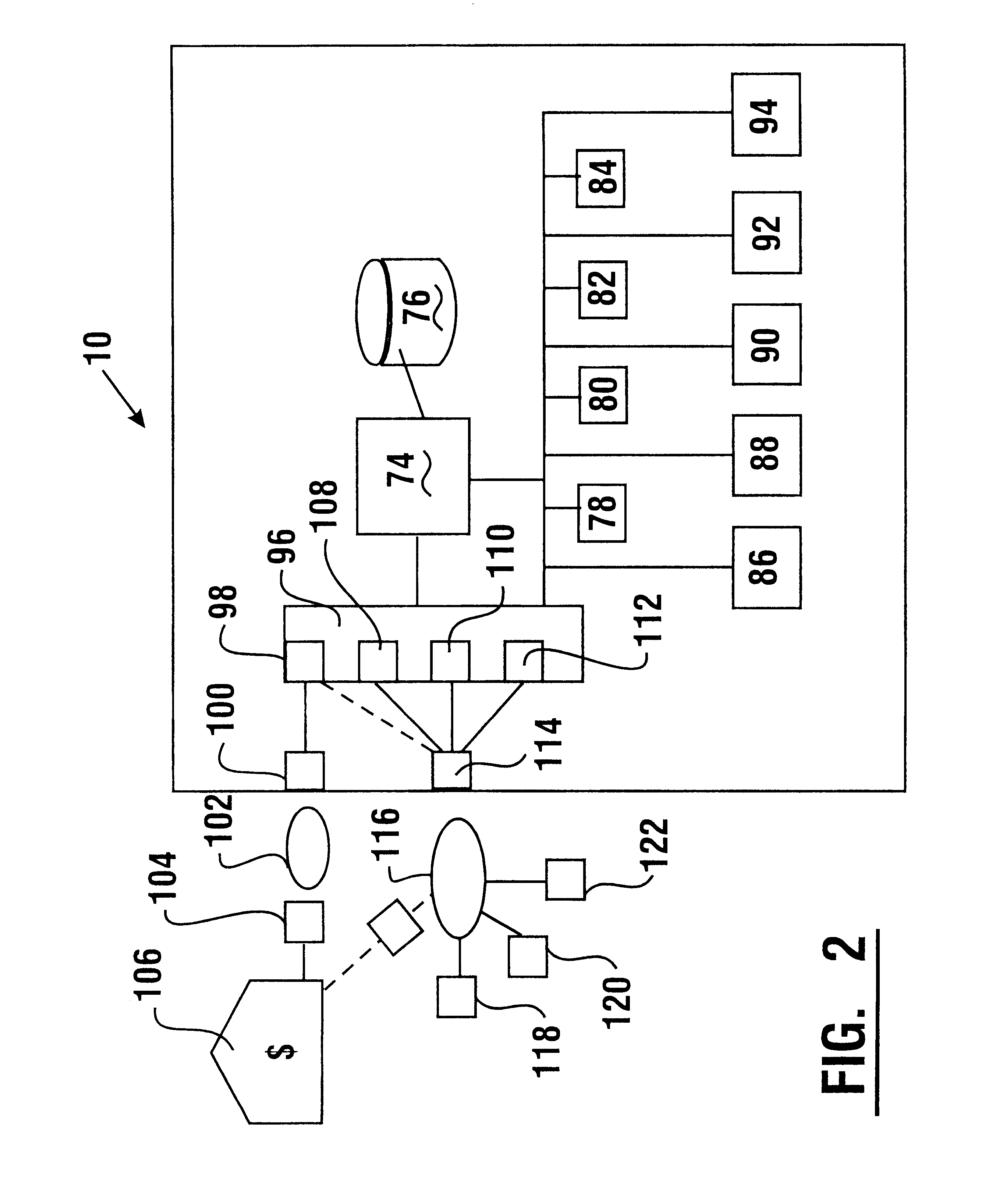

Method and system of evaluating checks deposited into a cash dispensing automated banking machine

InactiveUS7377425B1Improve reliabilityReduce riskComplete banking machinesFinanceTransaction dataCheque

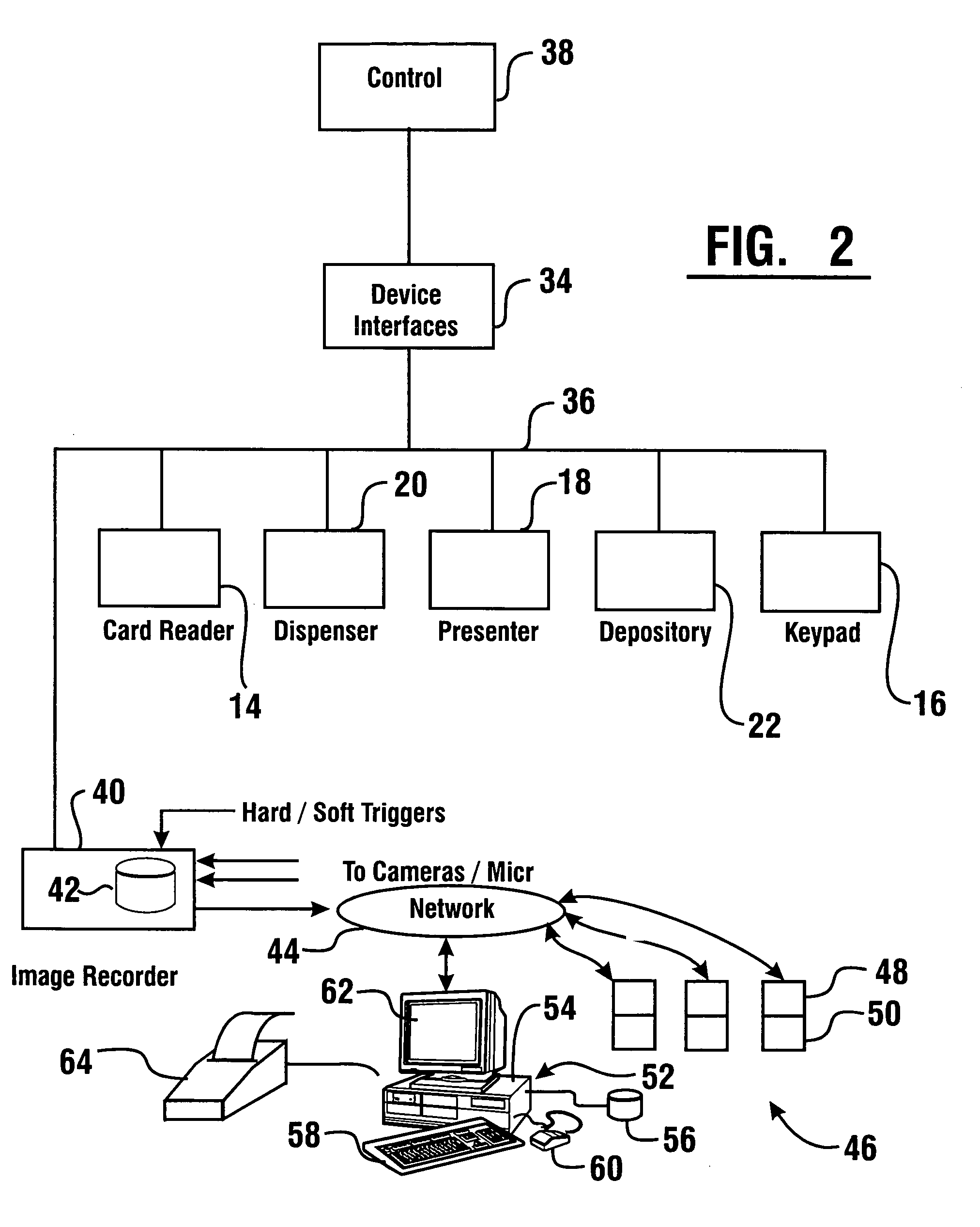

An automated banking machine system and method includes ATMs which accept checks and dispense cash to users. The ATMs are operated to acquire image and magnetic data from deposited checks to determine the genuineness of checks and the authority of a user to receive cash for such checks. Cash may be dispensed to the user from the ATM in exchange for the deposited check. The ATMs dispense cash responsive to communications with a transaction host. The transaction host provides transaction identifying data to the ATM. The ATM sends the transaction identifying data and check images to an image and transaction data server for processing.

Owner:DIEBOLD SELF SERVICE SYST DIV OF DIEBOLD NIXDORF INC

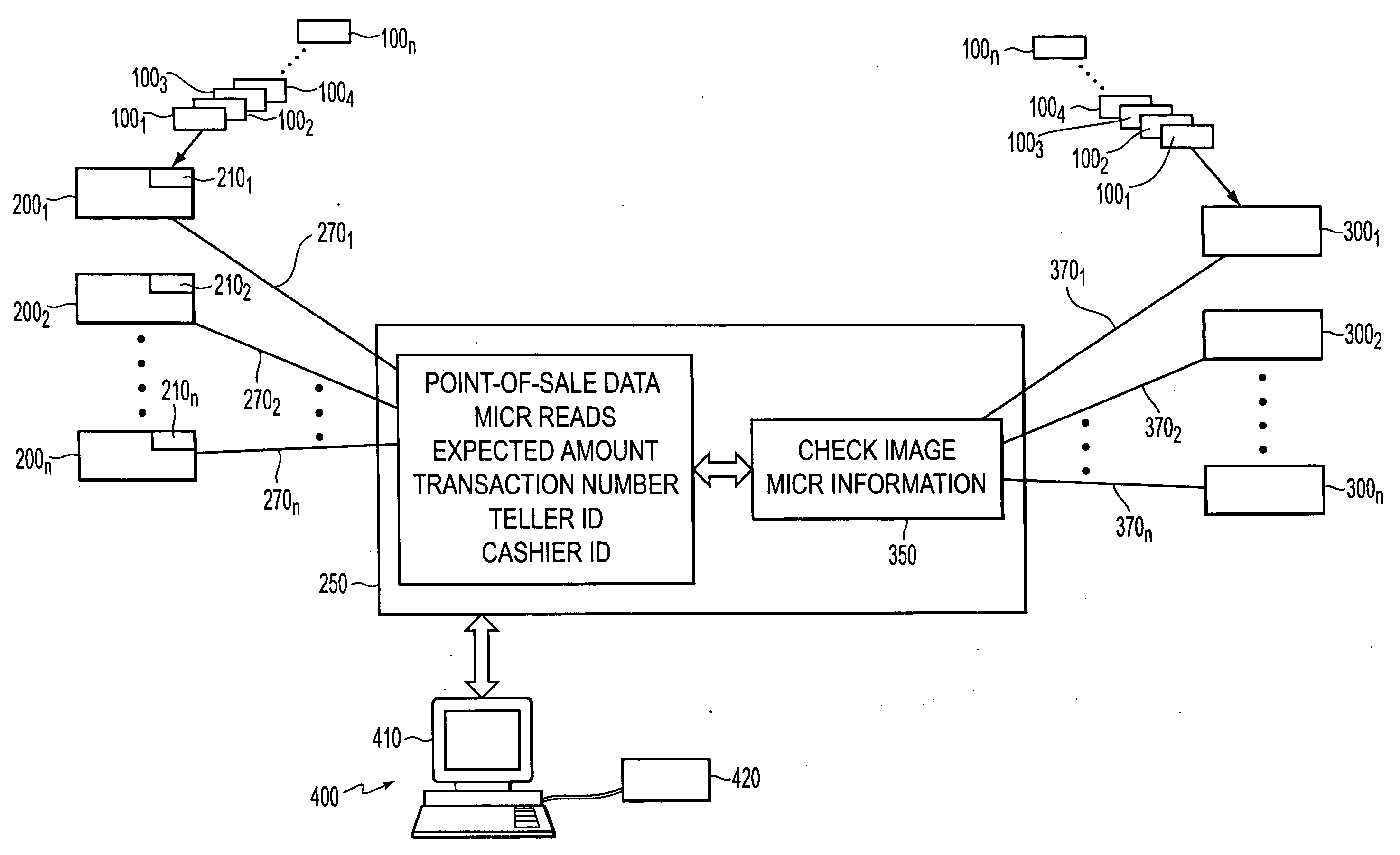

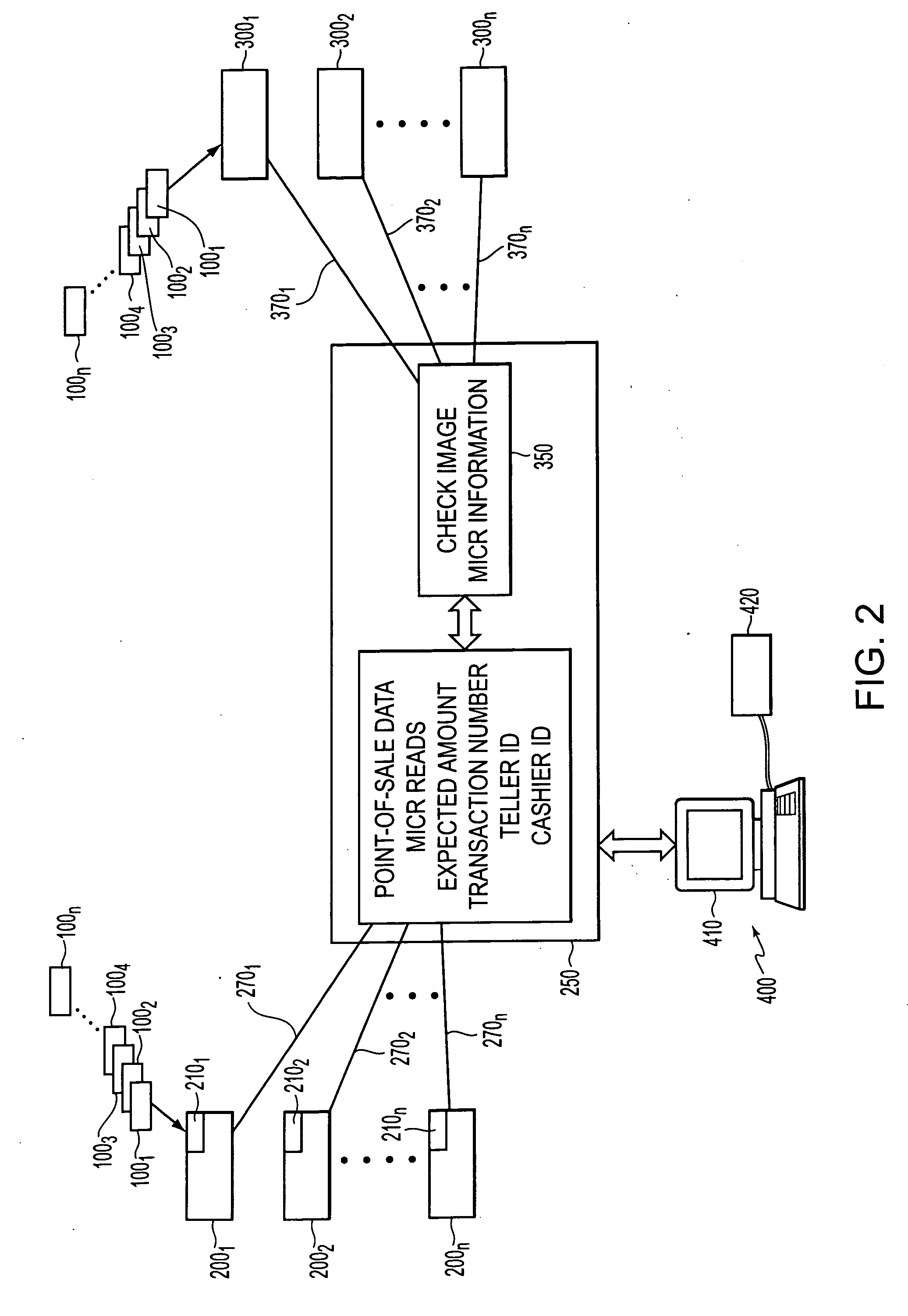

Method and apparatus for processing checks

ActiveUS20050108168A1Reduce physical activityImprove process integrityComplete banking machinesFinanceAlgorithmCheque

A check processing system and method comprising utilizes an image scanner that produces an electronic image of a check upon scanning of the check. The system and method receive the electronic image of the check from the image scanner, receive point-of-sale data generated at a point-of-sale, determine a monetary value of the check from the electronic image of the check, and reconcile the determined monetary value of the check with the point-of-sale data so that the check is correlated with a transaction that occurred at the point-of-sale.

Owner:TALARIS HLDG

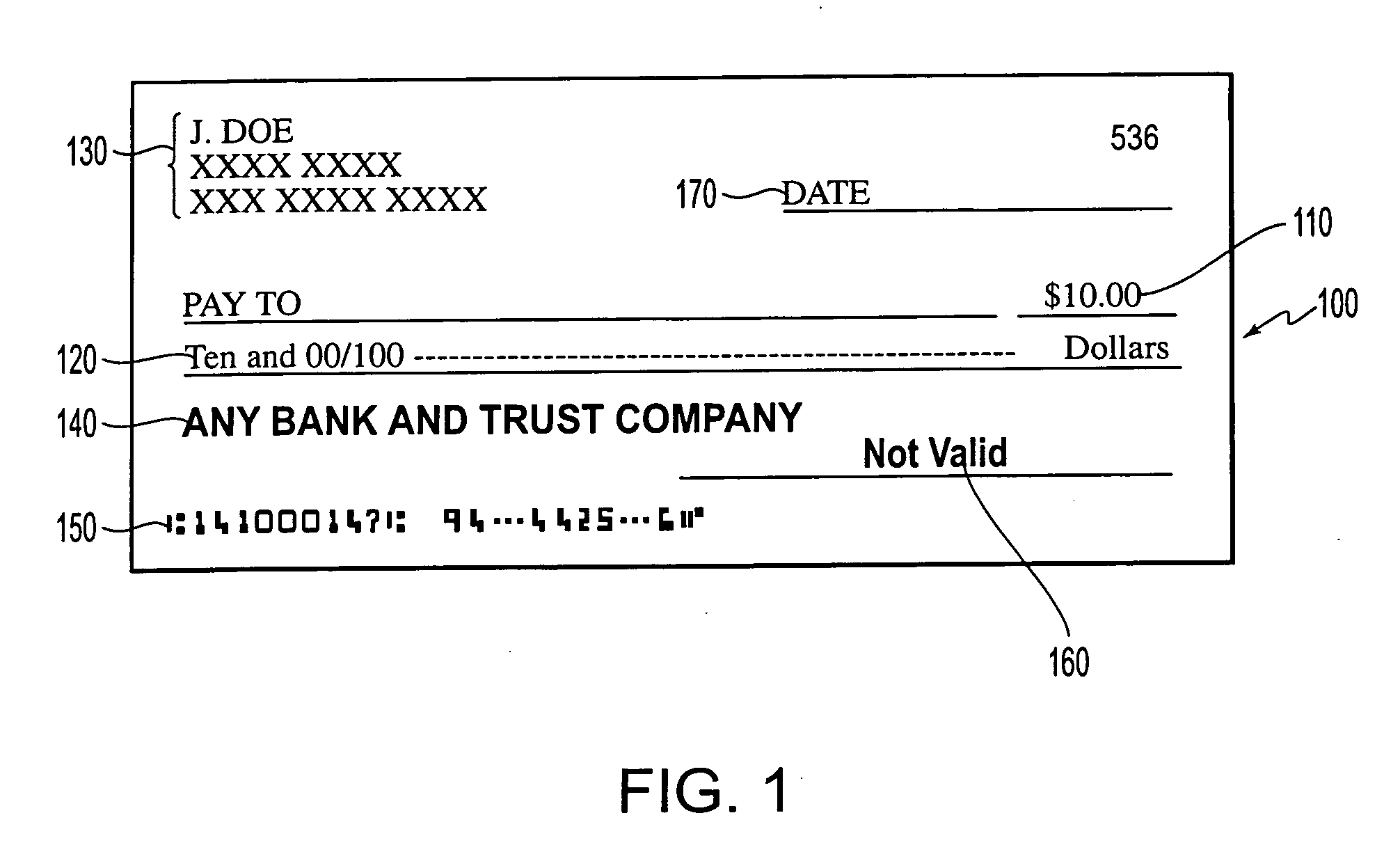

ATM check invalidation and return systems and methods

Systems, methods, and software are described for check processing at an ATM. A check may be received at an ATM, and an image of the check may be captured. It may then be verified that the image captured meets an established quality standard. The ATM may then print on the check to indicate that it is not negotiable, and the check may be discharged from the ATM to the user.

Owner:FIRST DATA

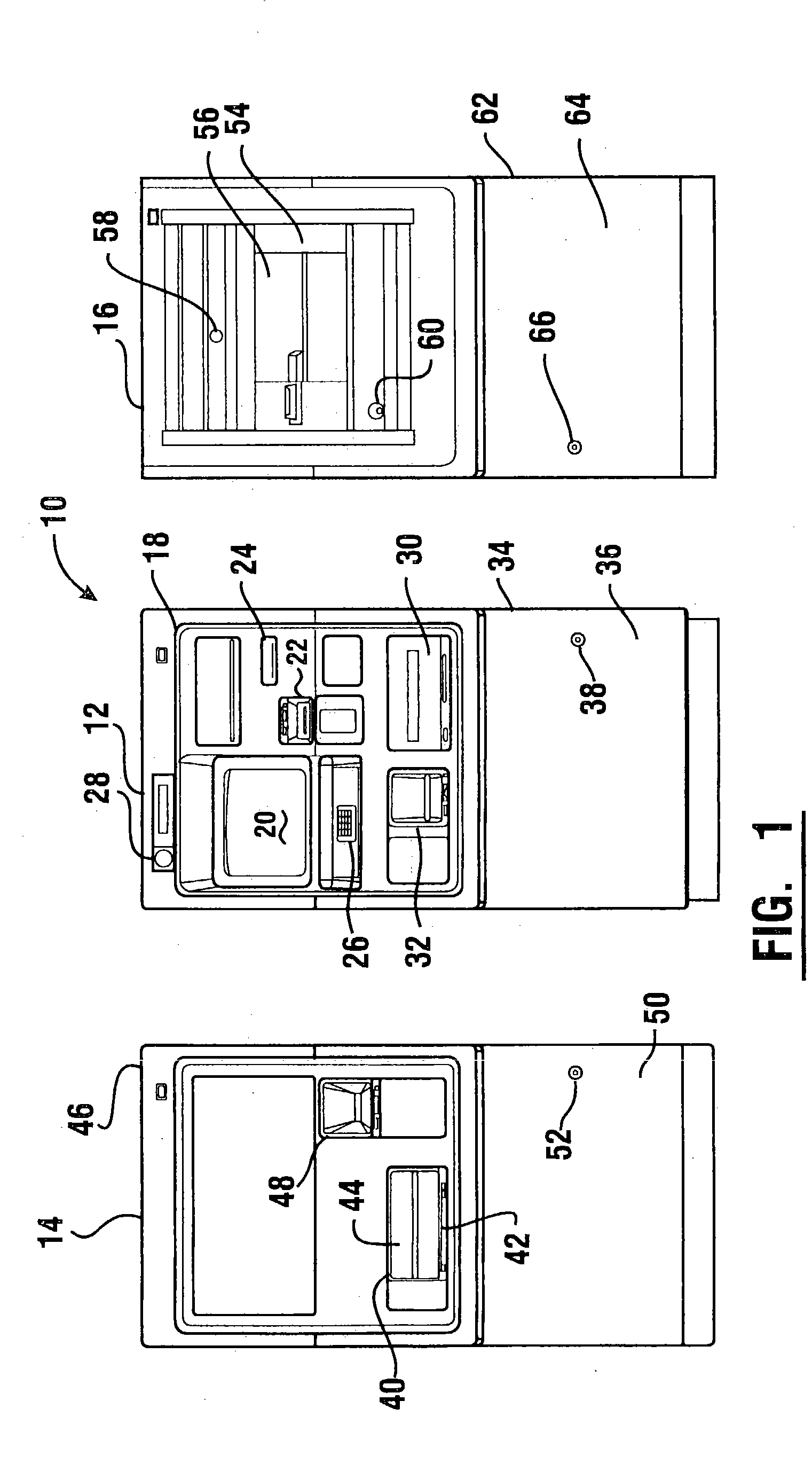

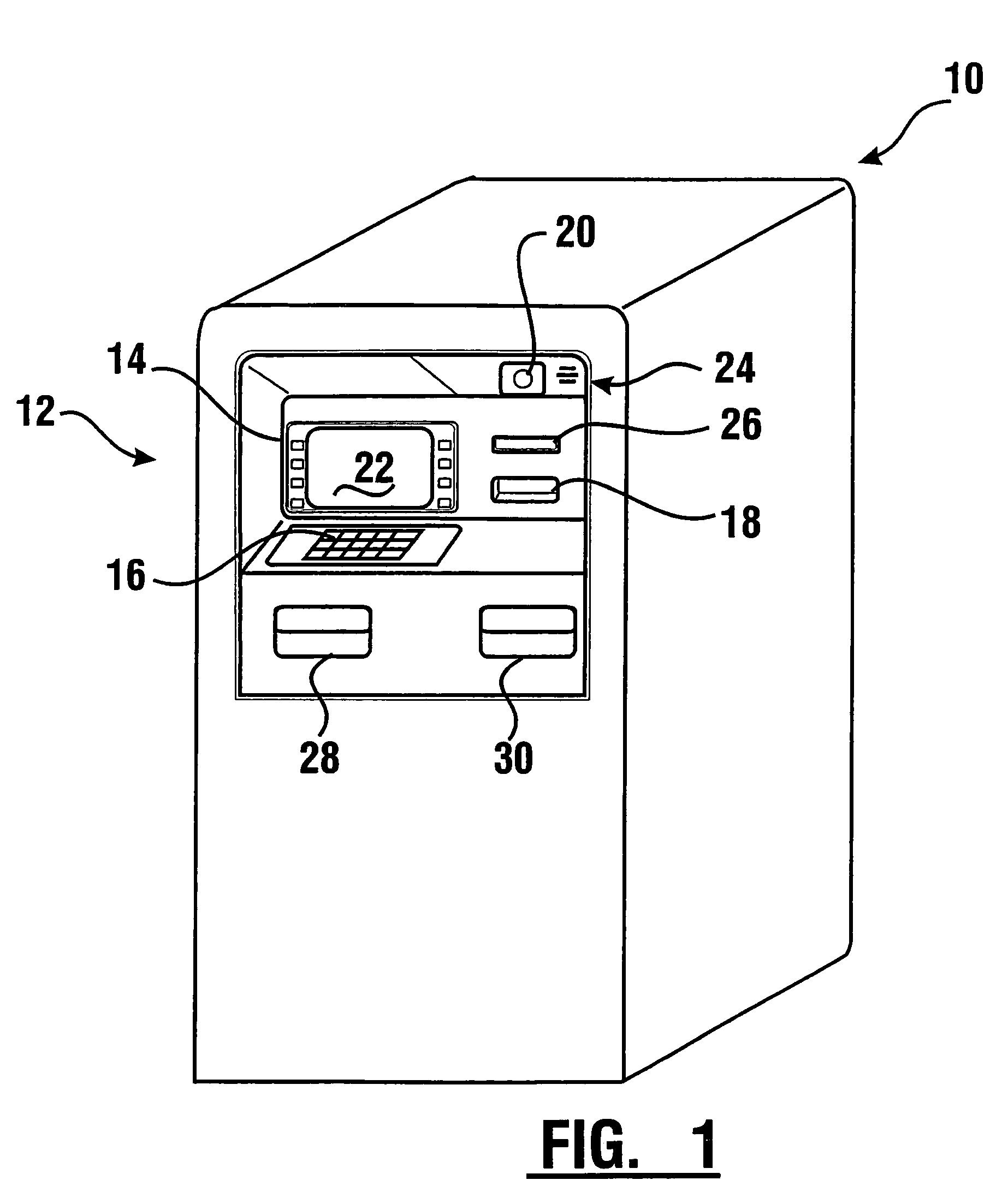

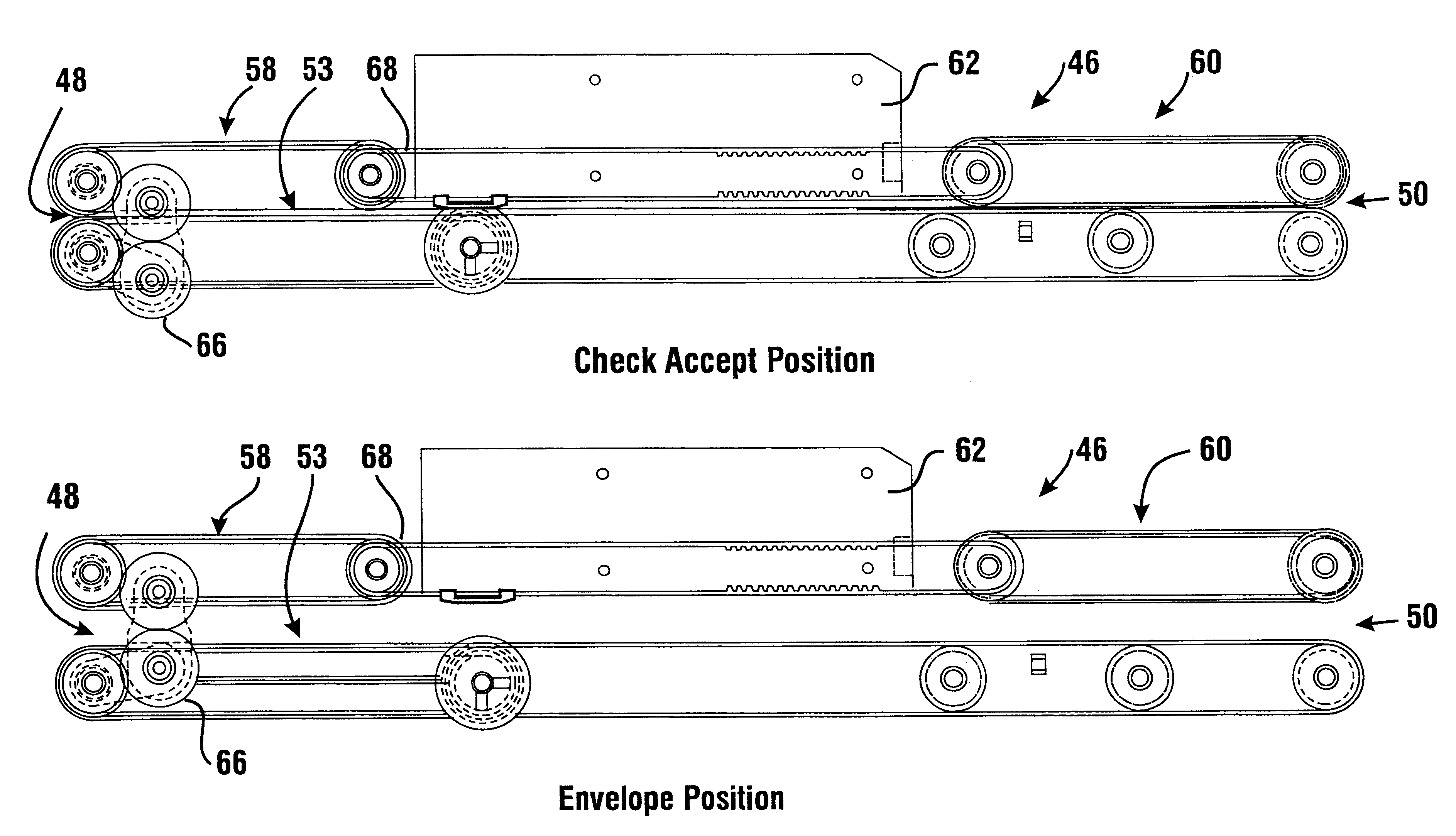

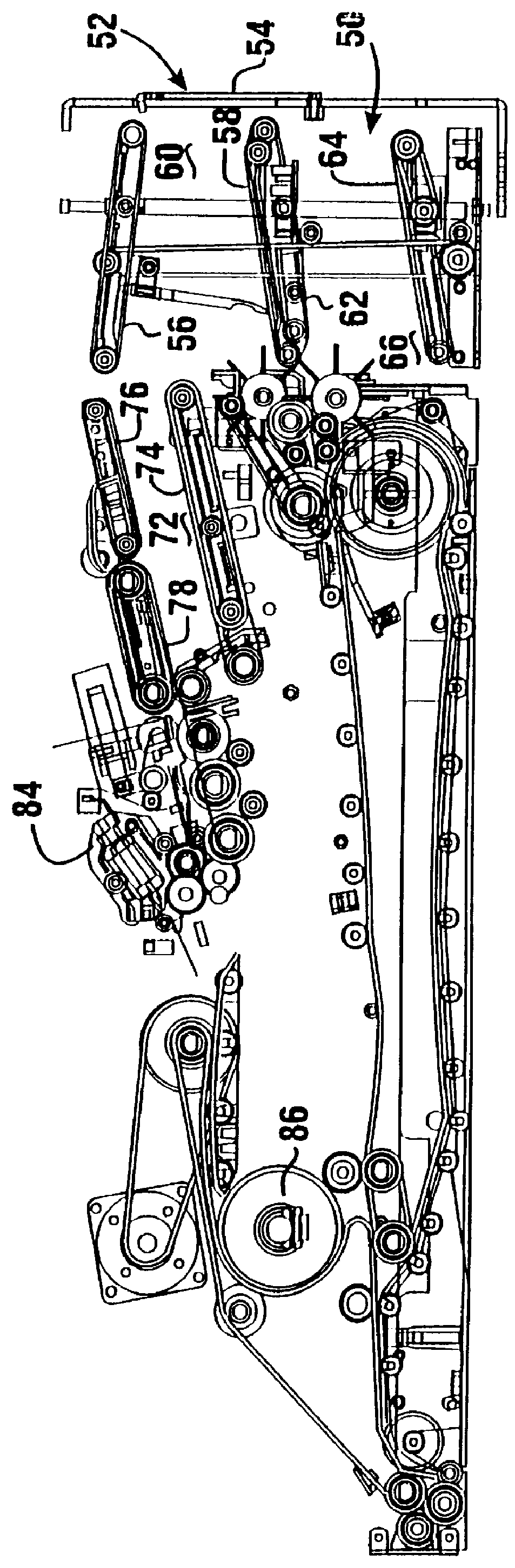

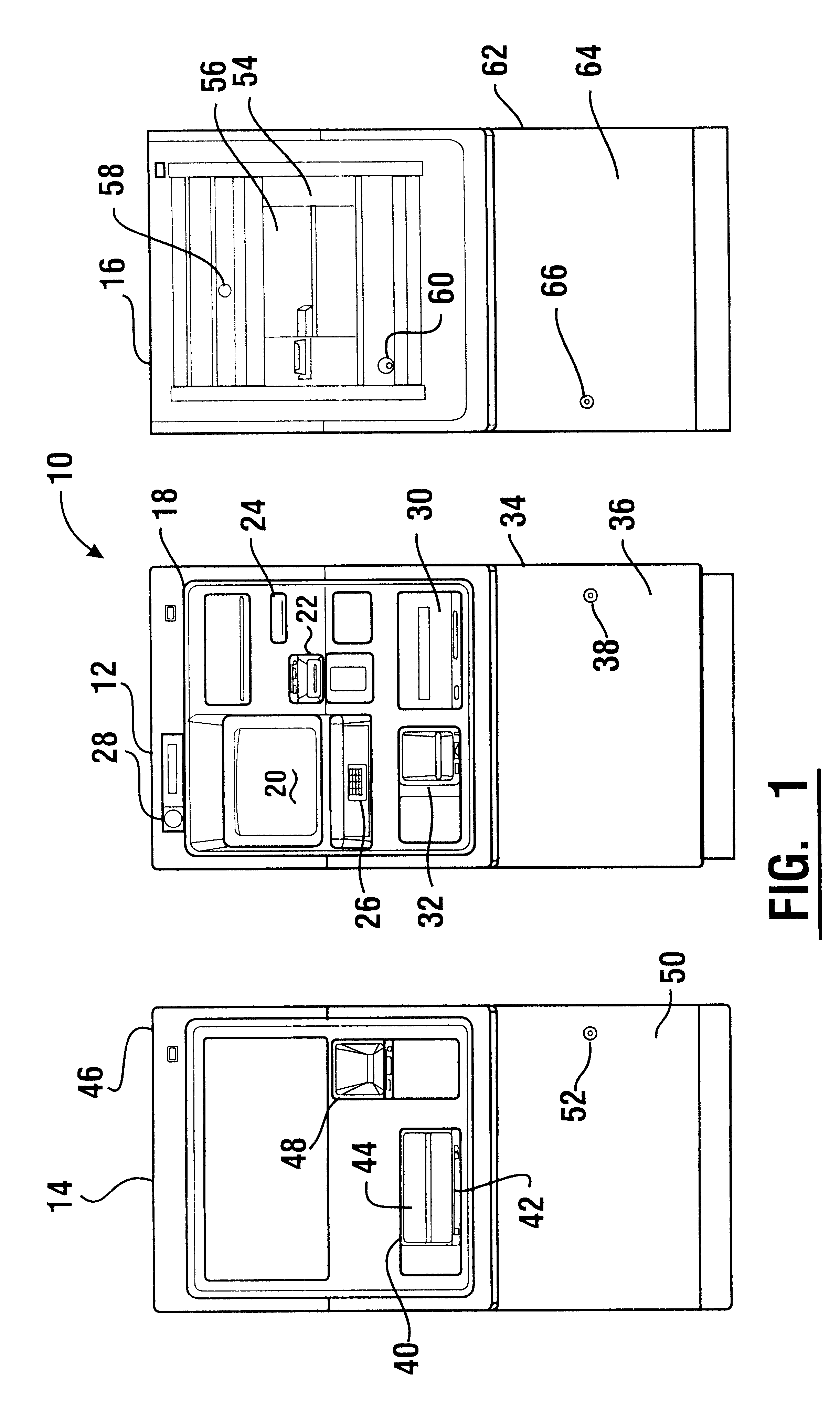

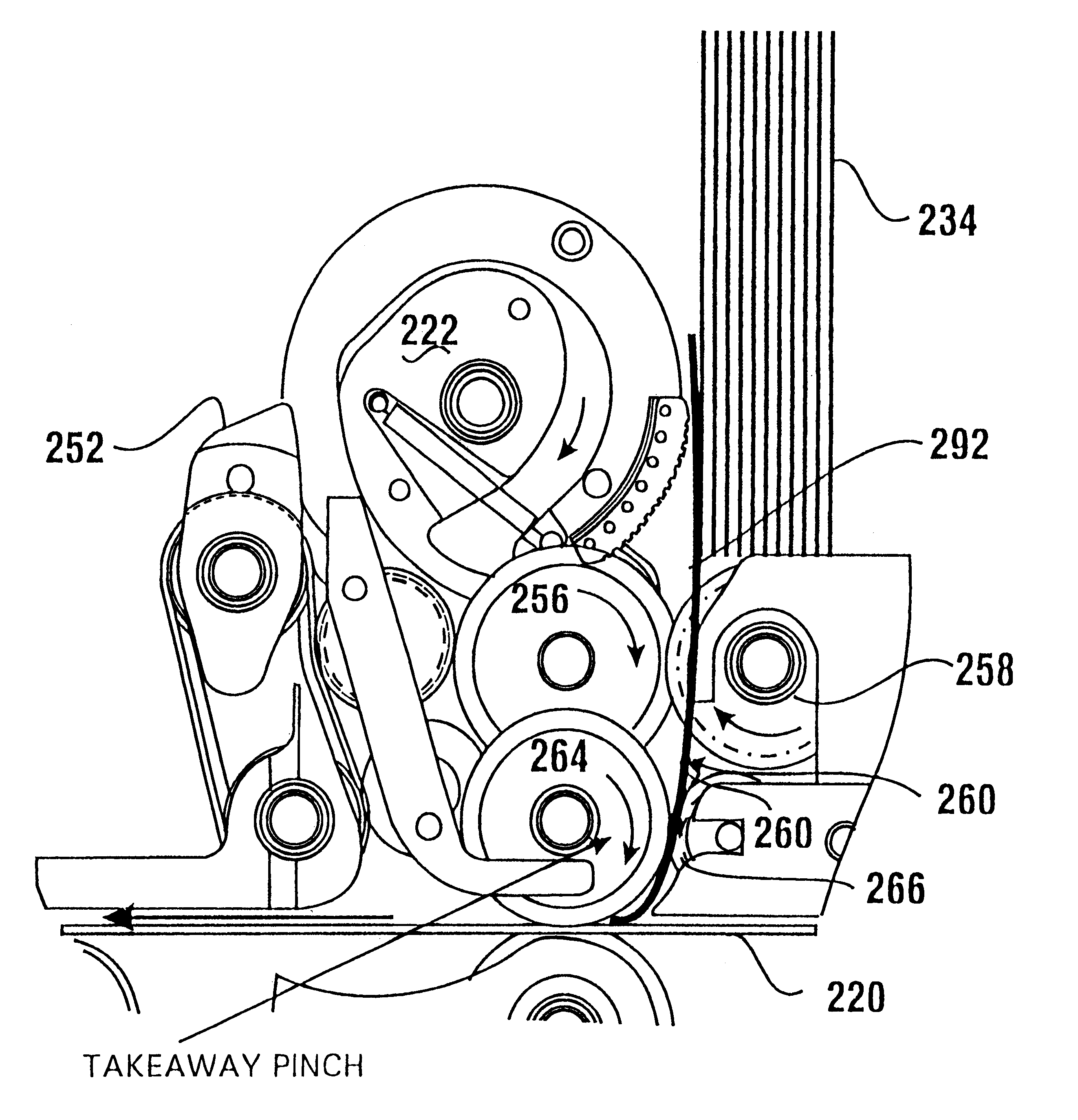

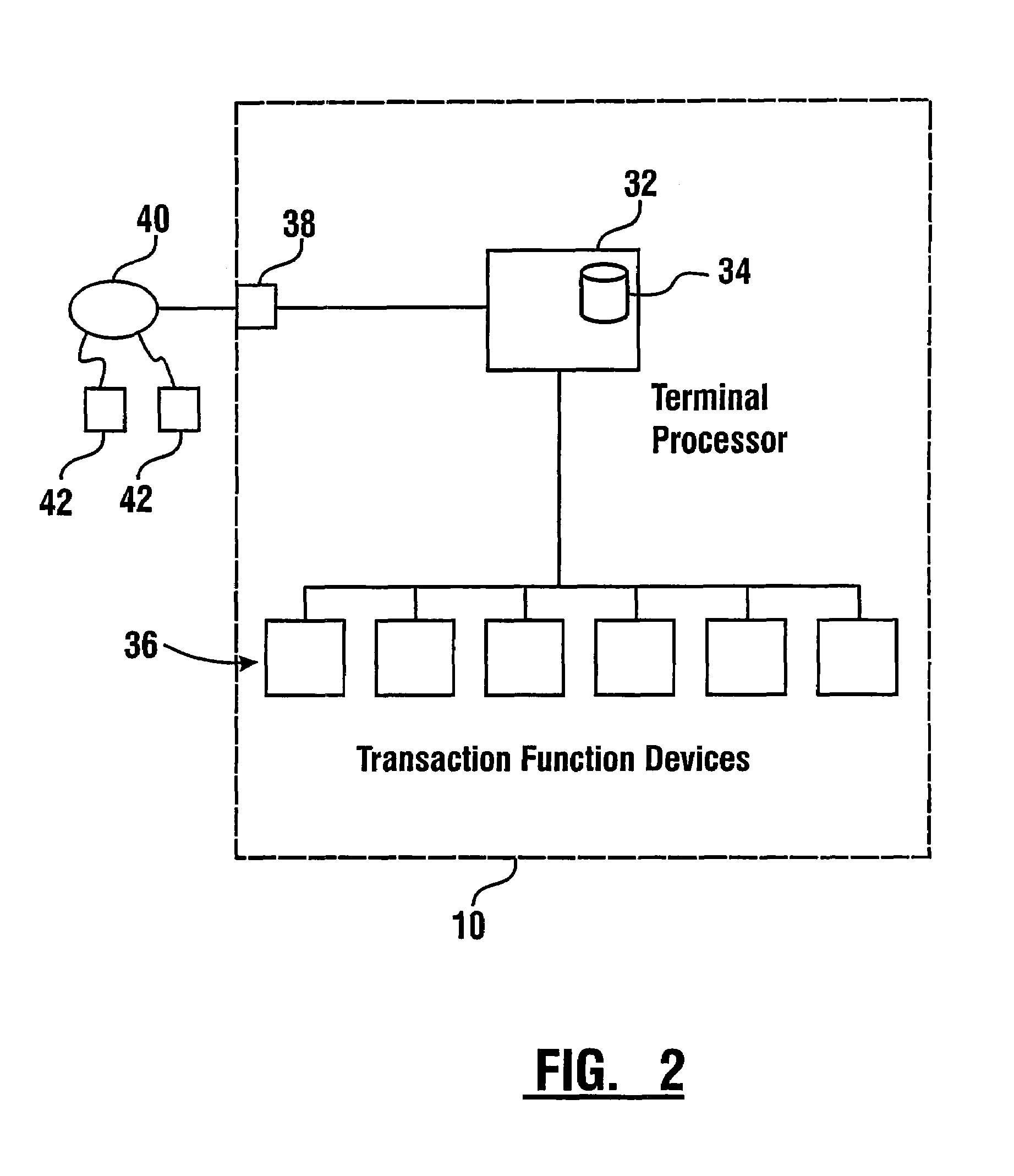

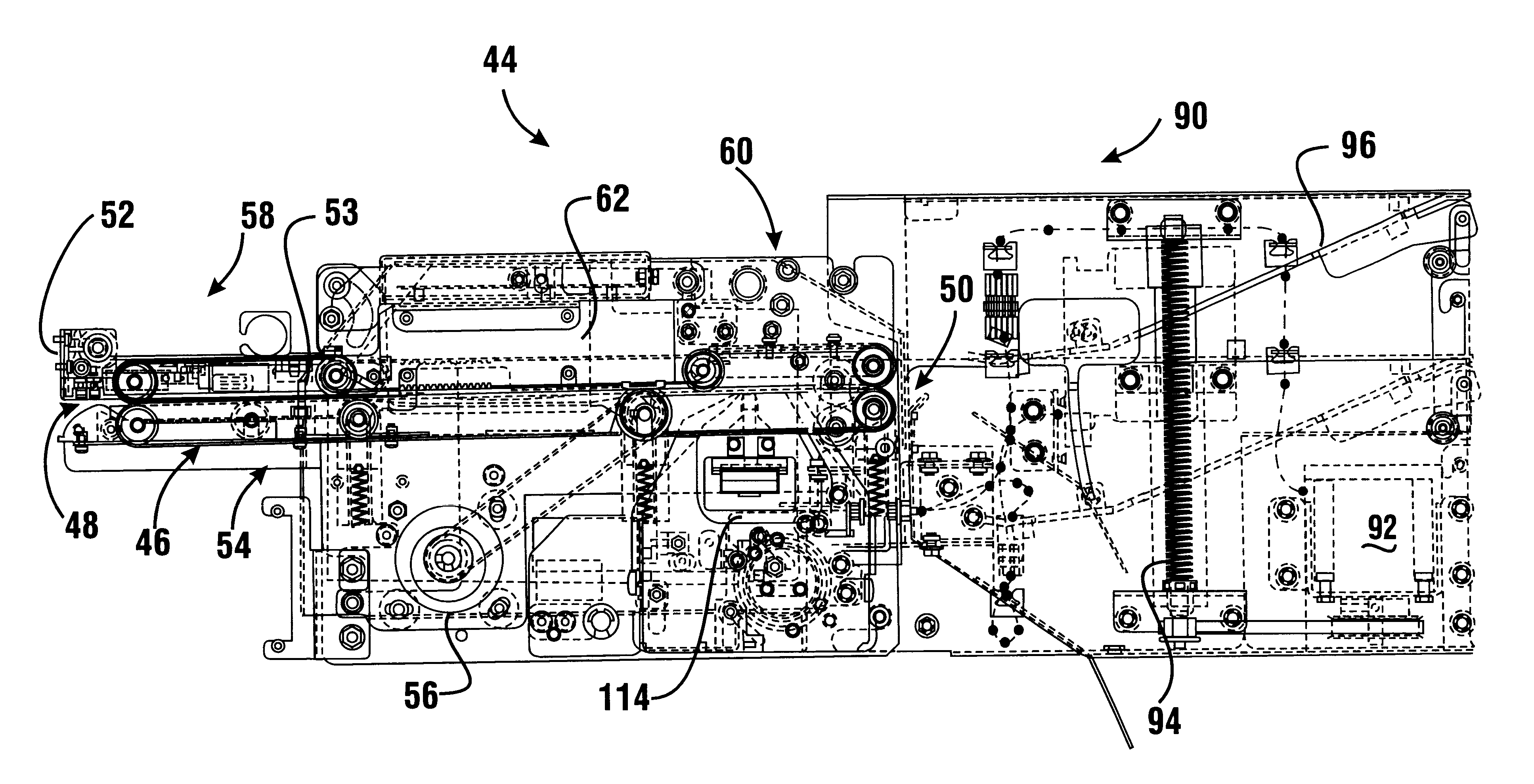

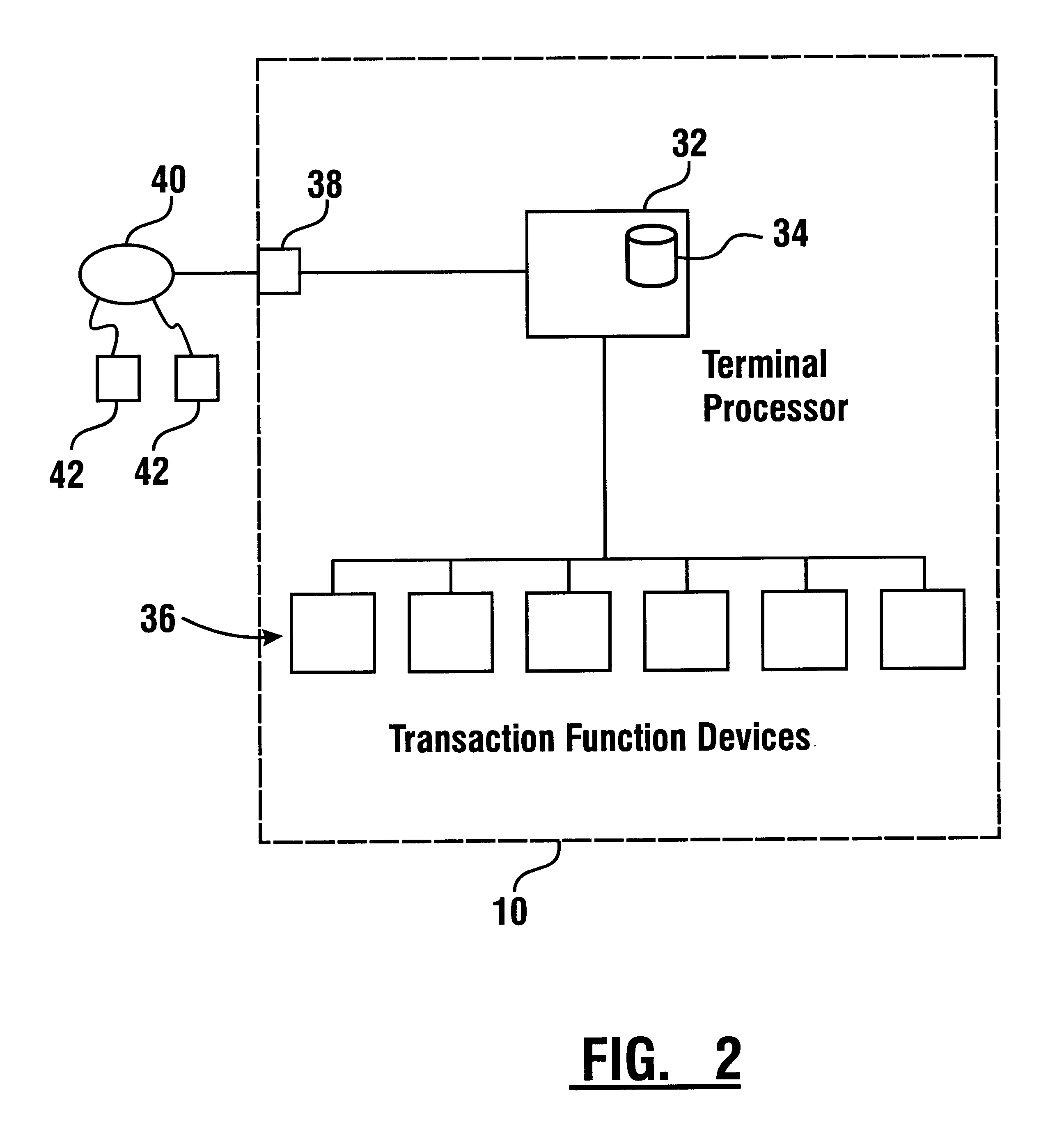

Deposit accepting apparatus and system for automated banking machine

InactiveUS6554185B1Improve reliabilityMinimize damageComplete banking machinesFinanceComputer moduleEngineering

An automated banking machine (10) includes a deposit accepting apparatus (44) which is capable of accepting and authenticating instruments, as well as accepting envelopes deposited into the machine by a user. A transport section (46) is operative to engage and transport deposited items selectively from an inlet (48) to an outlet (50). A deposit holding module (90) includes compartments (98, 106) which are operative to hold different types of deposits. The machine operates to selectively move a compartment into communication with the outlet based on the particular type of item being deposited. The depository apparatus is further operative to acquire image and magnetic profile data from deposited instruments, to manipulate the image and profile data and to analyze and resolve characters in selected areas thereof. The data from deposited instruments is used for determining if a user is authorized to conduct certain requested transactions at the machine.

Owner:DIEBOLD NIXDORF

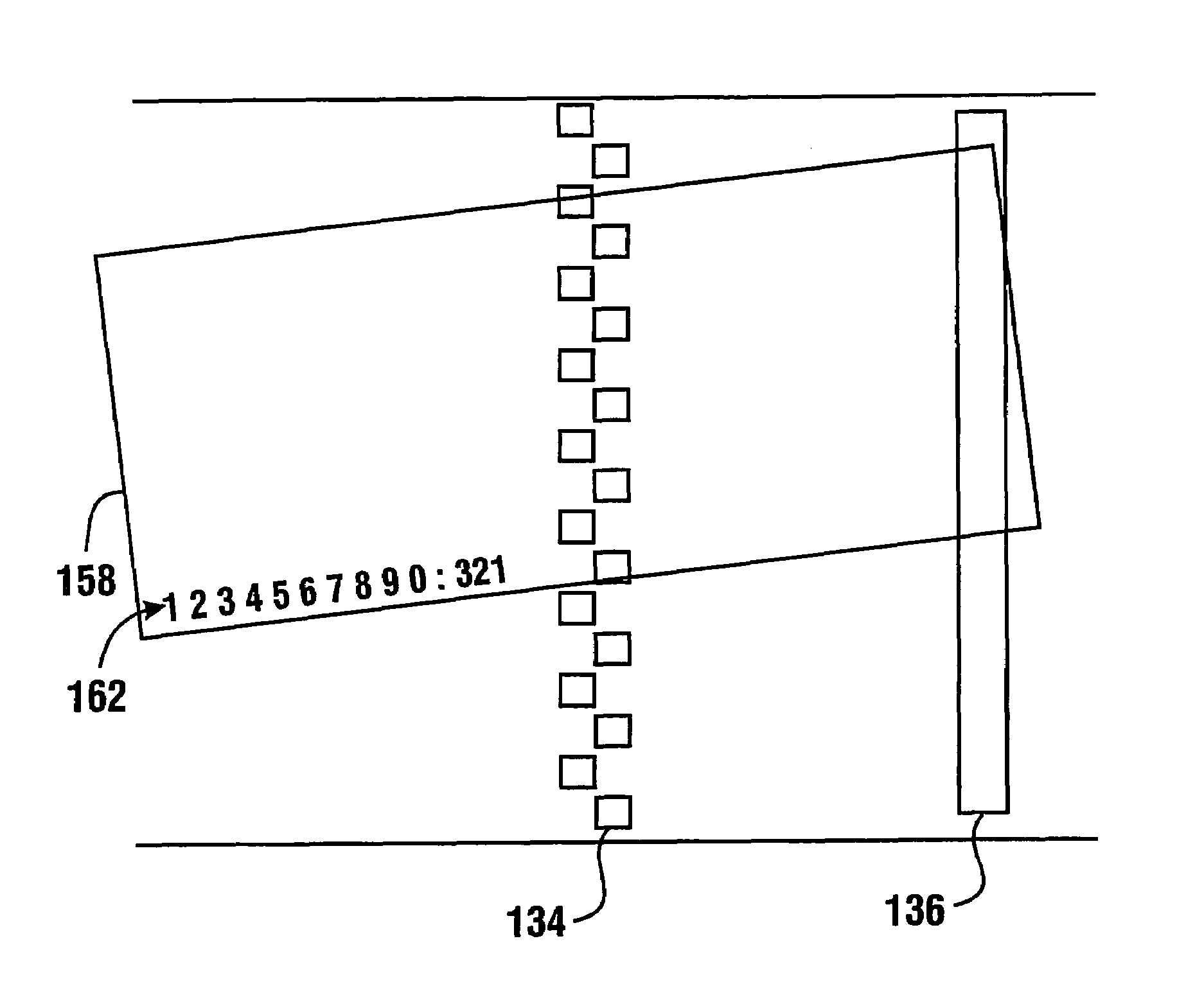

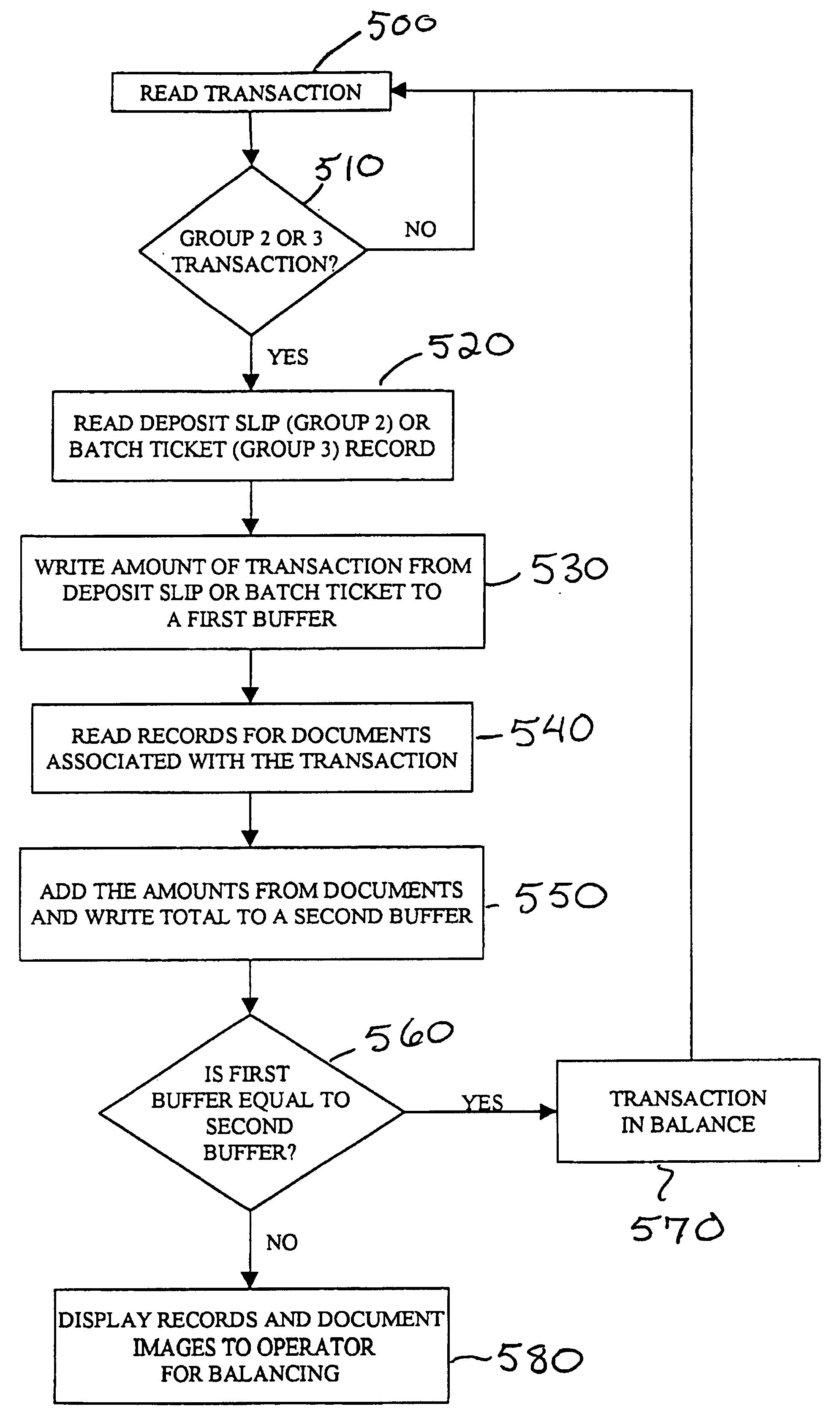

System and method for back office processing of banking transactions using electronic files

InactiveUS7062456B1Reduce equipmentReduce laborFinanceAutomatic teller machinesBank tellerRelevant information

As banking transactions are processed by a bank teller, all of the relevant information with respect to the transaction (e.g., dollar amount) is captured in an electronic file. Each of the electronic files from the various branches of the bank are forwarded to a central back office processing center where the electronic files are combined into a single Transaction Repository. At the end of the branch day, all of the paper associated with the transactions is forwarded from the branches to the back office processing center. The paper transactions are imaged in the conventional manner and the Magnetic Ink Character Recognition (MICR) data is read from the paper. The present invention then automatically correlates the images and MICR data captured from the paper with the complete transaction record contained in the Transaction Repository. Most of the conventional back office processing can now be performed without the need to perform character recognition and without the need for excess human intervention.

Owner:JPMORGAN CHASE BANK NA

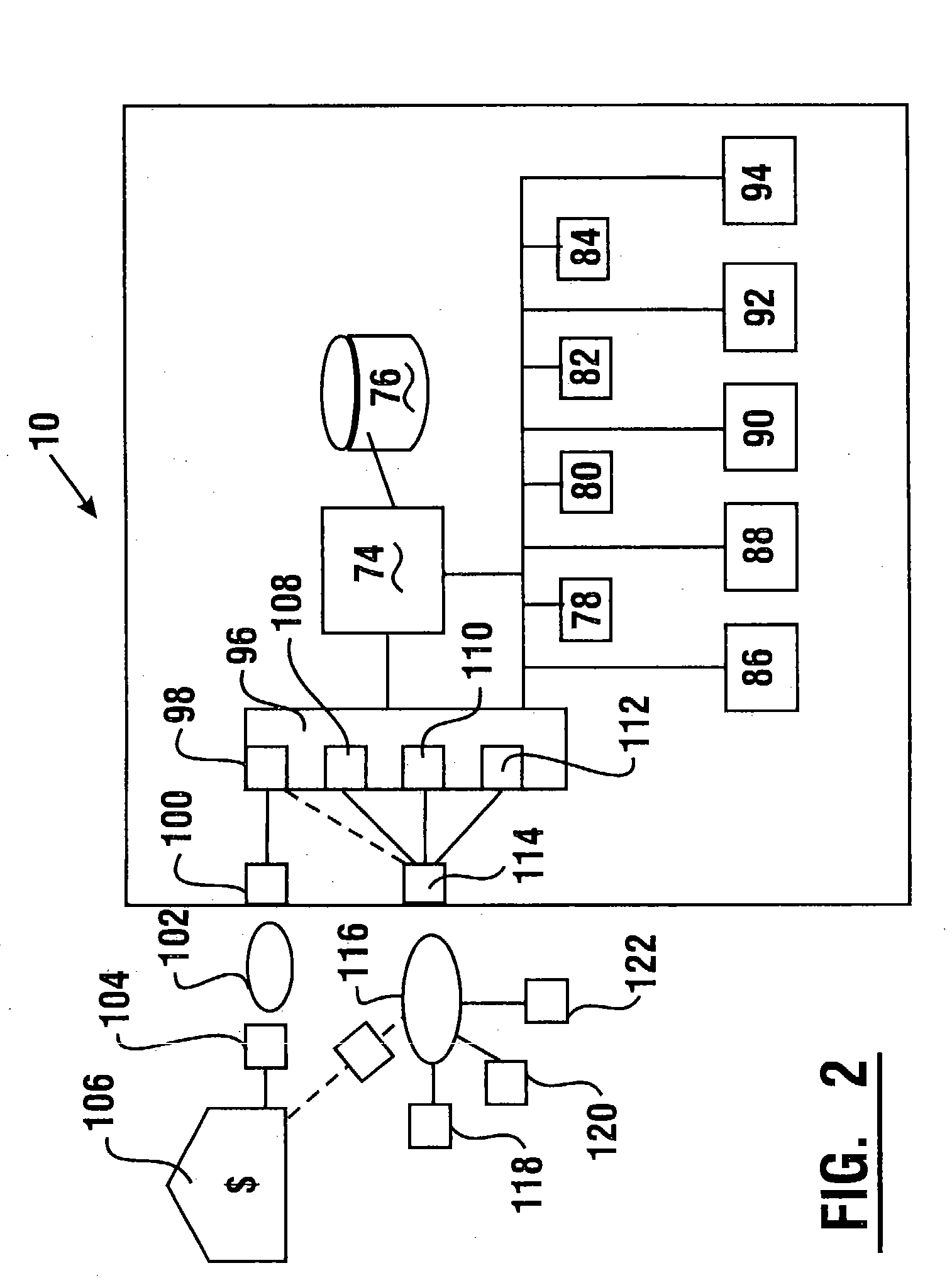

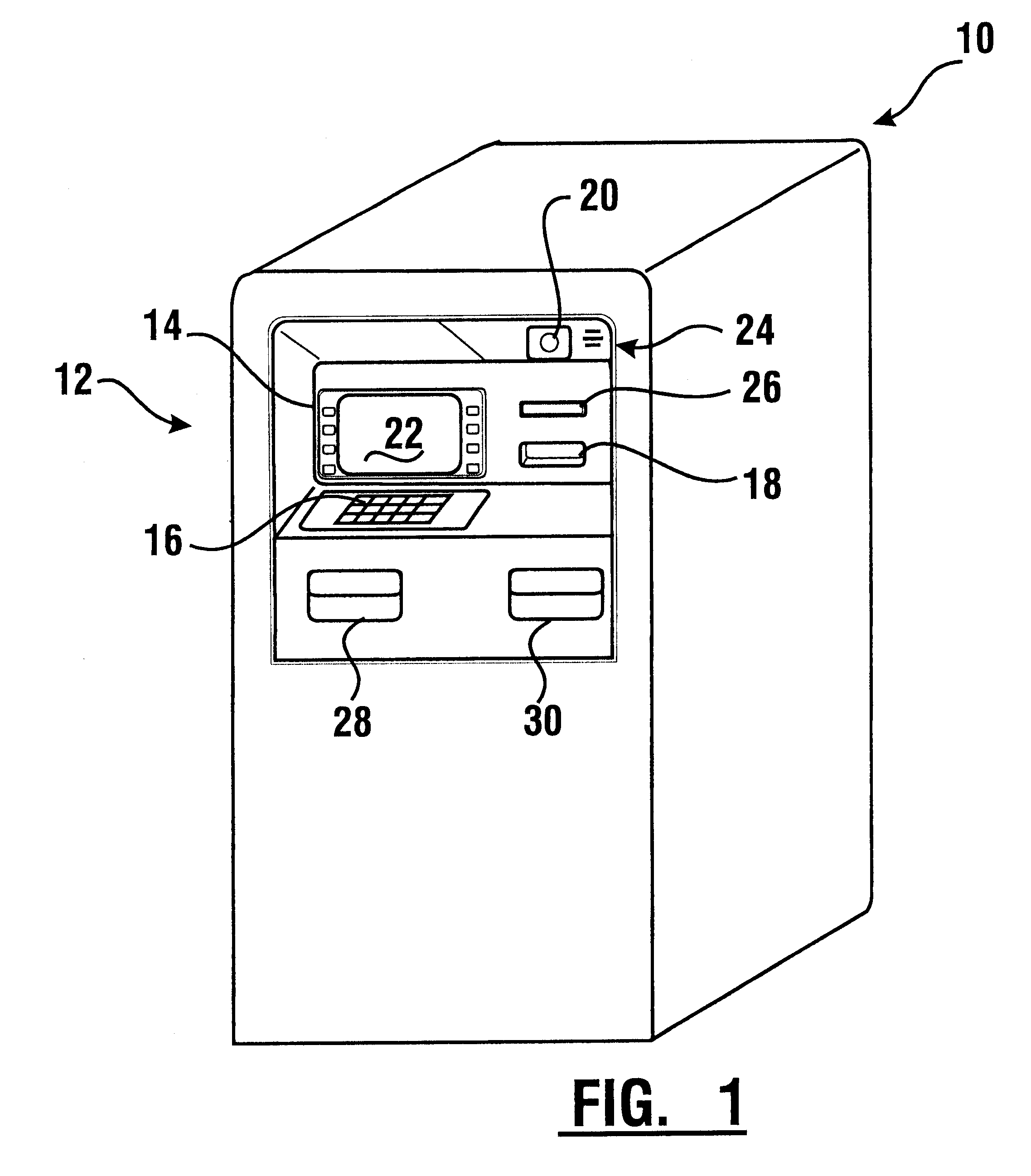

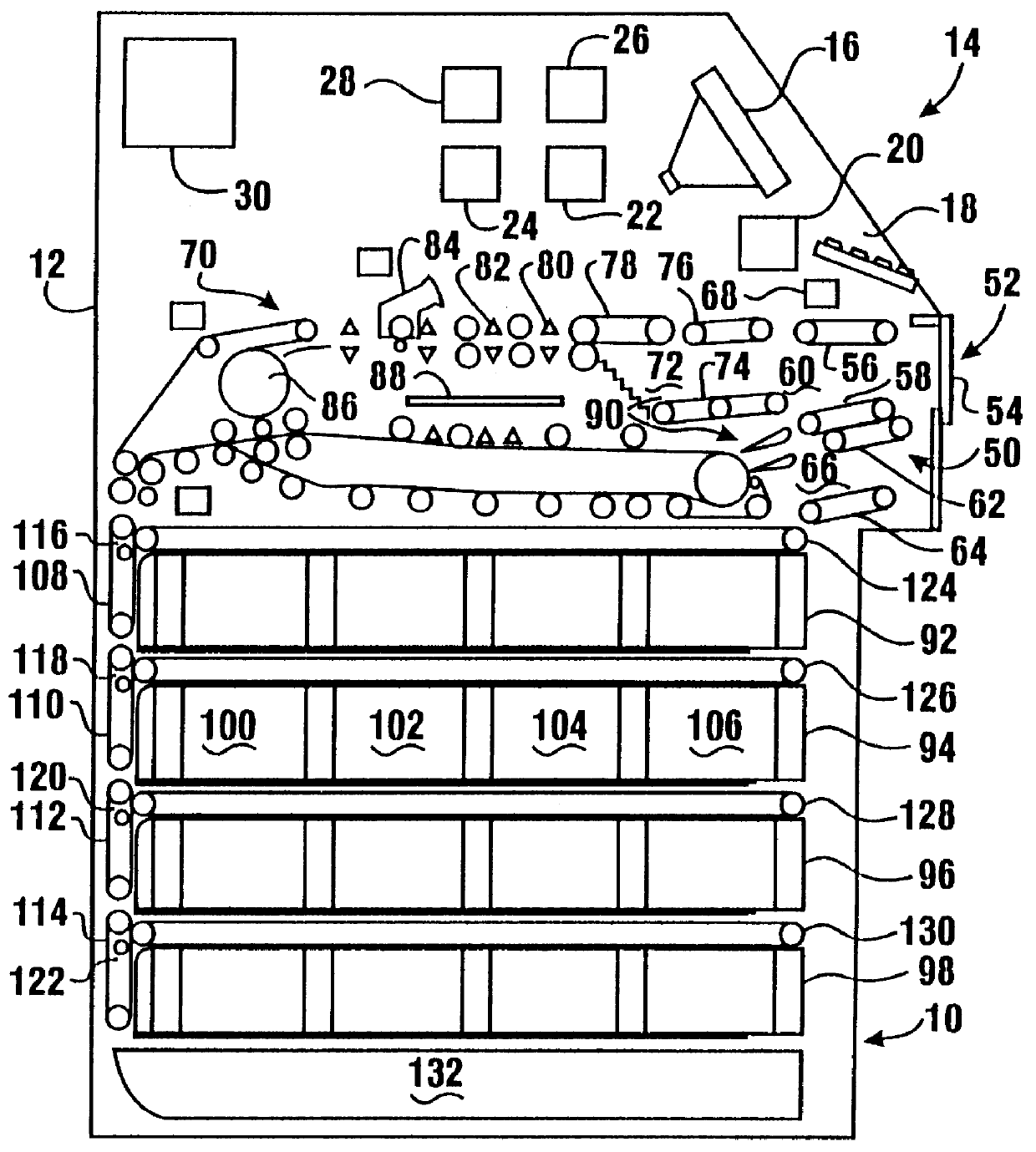

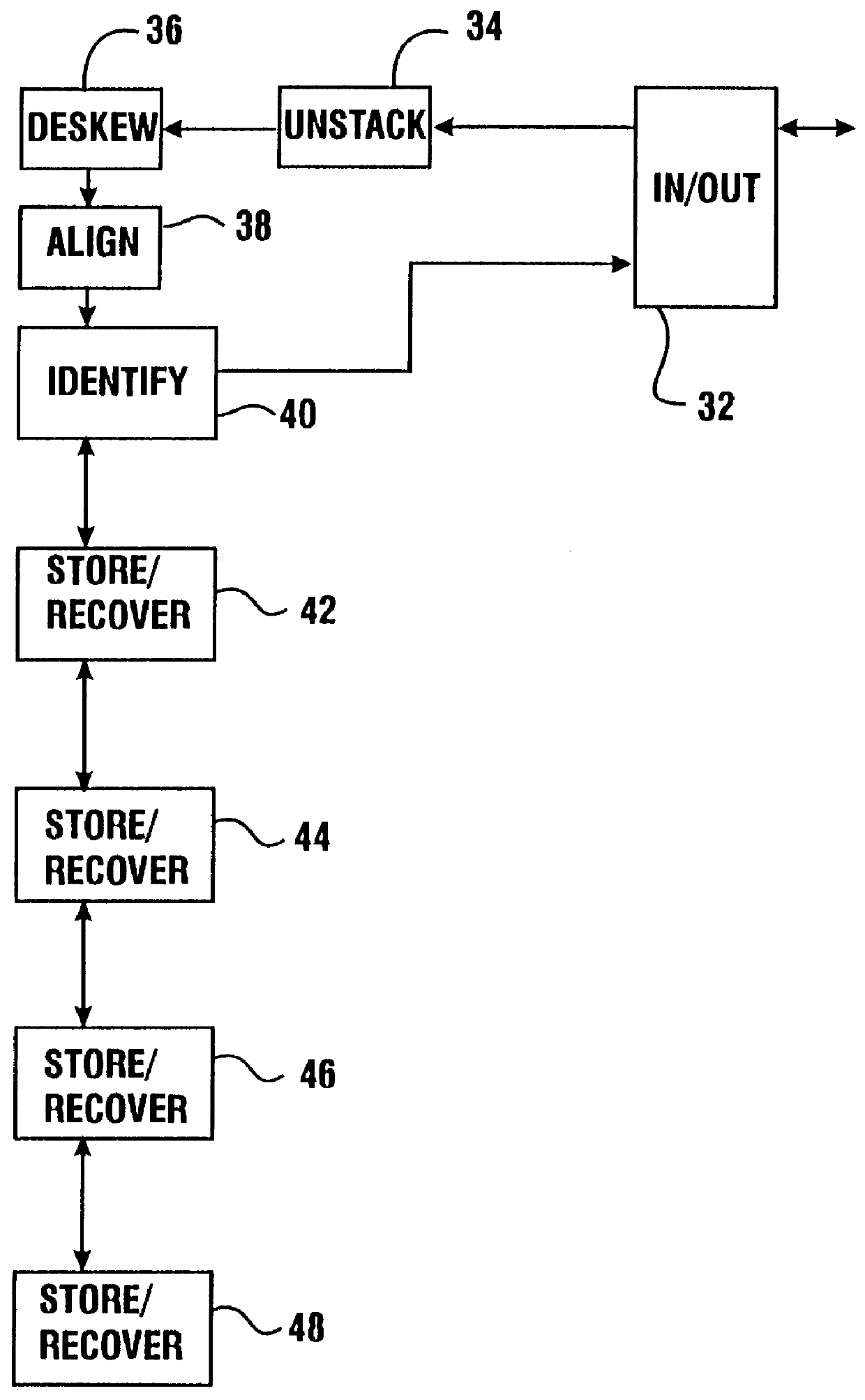

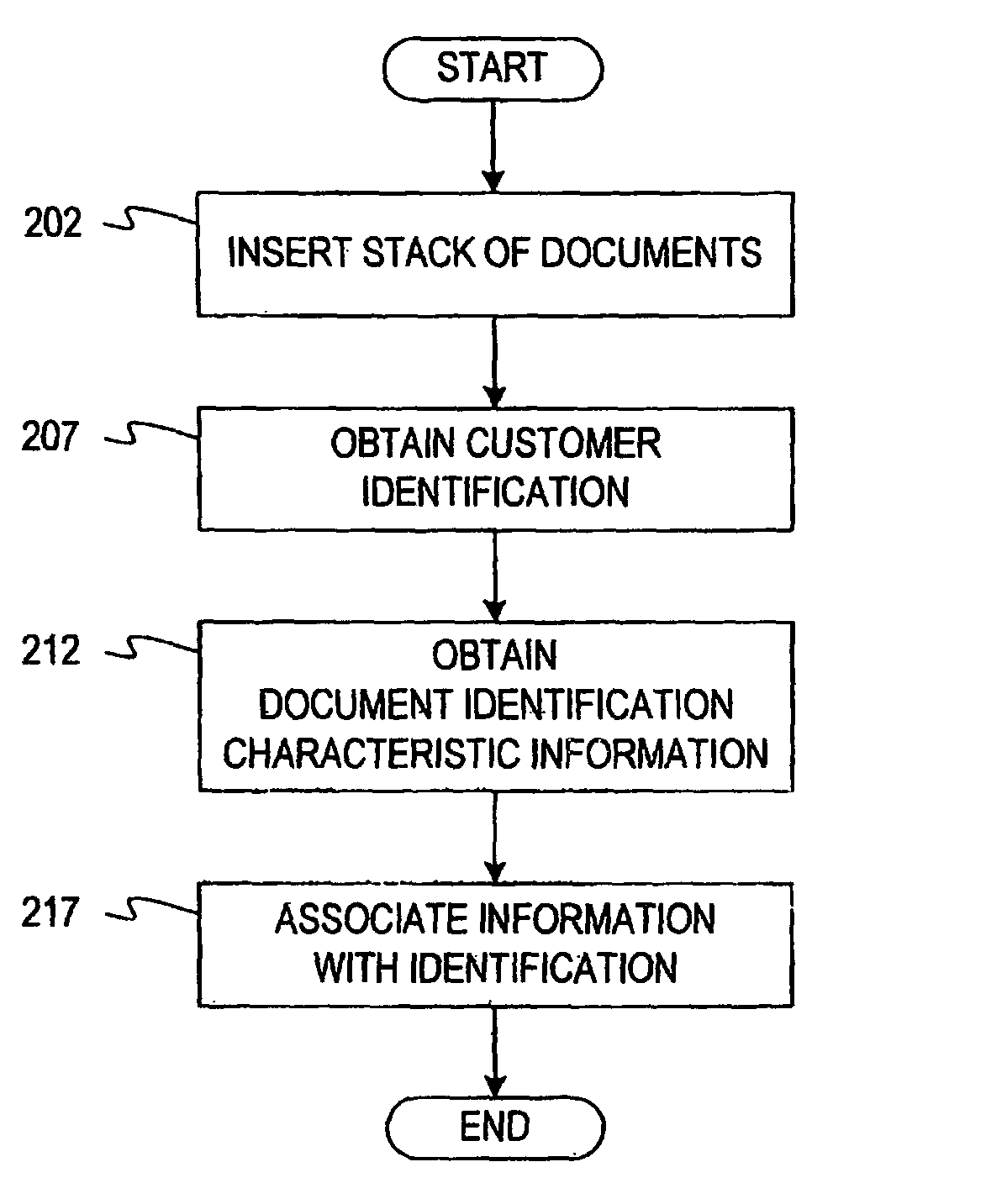

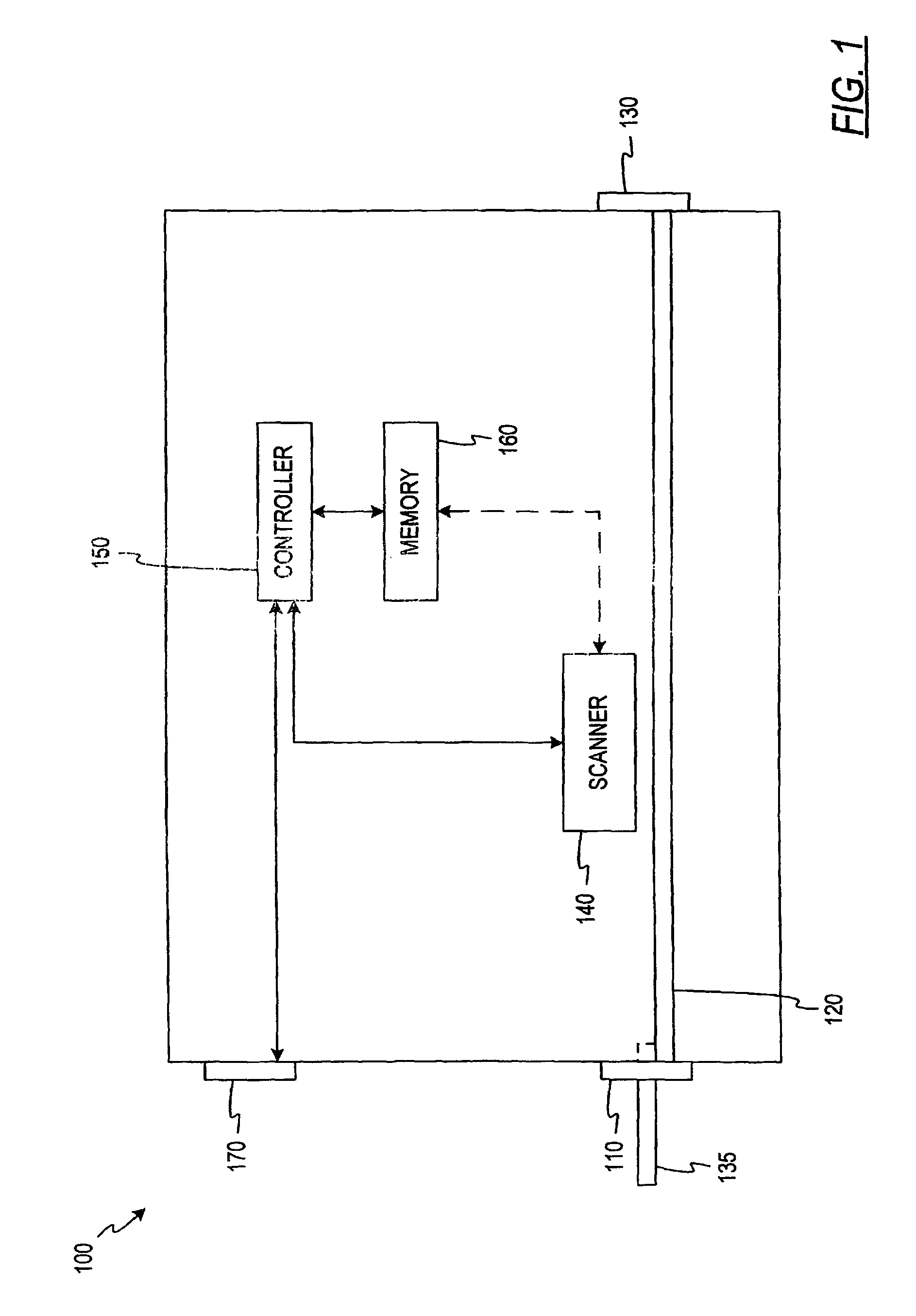

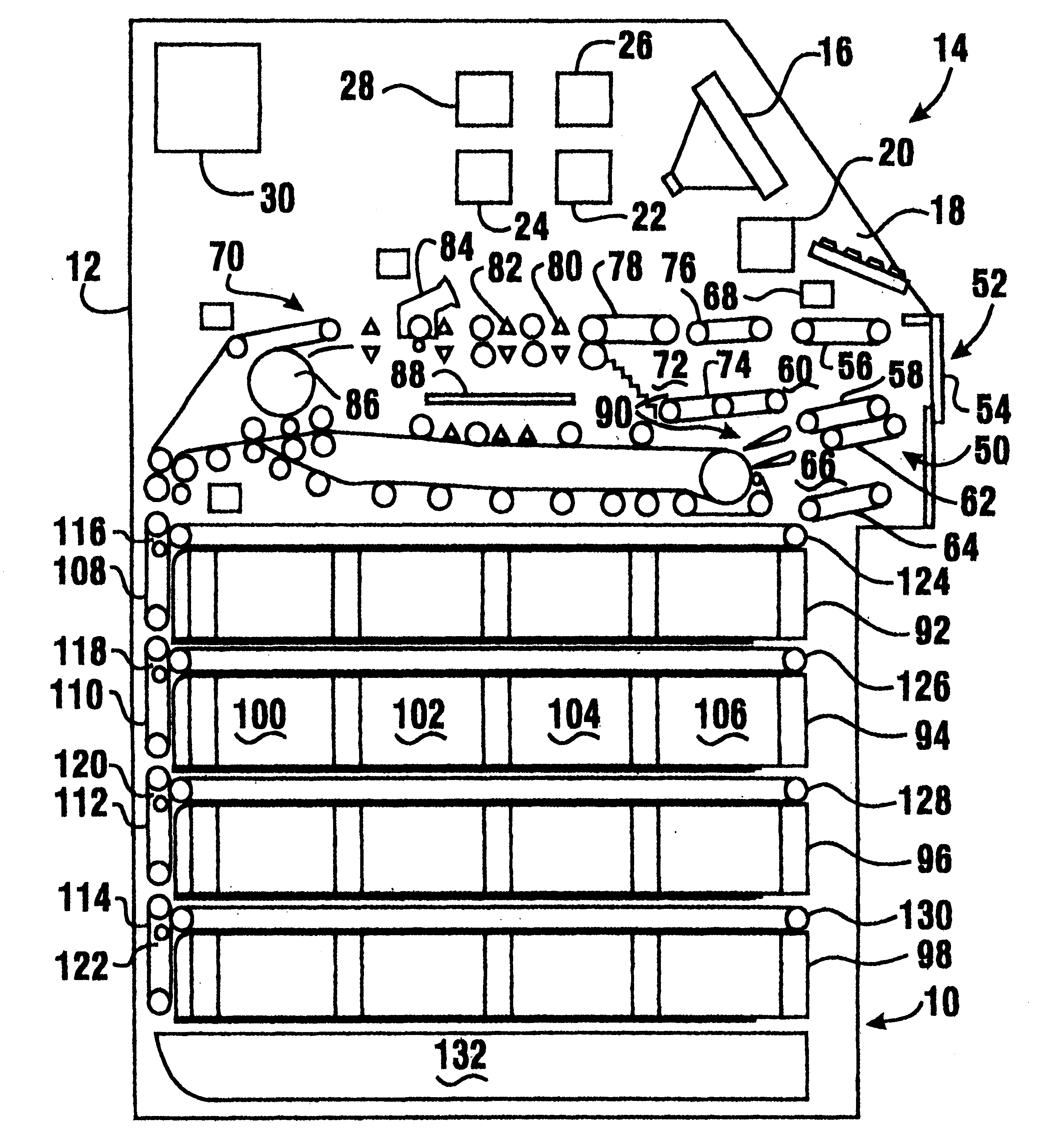

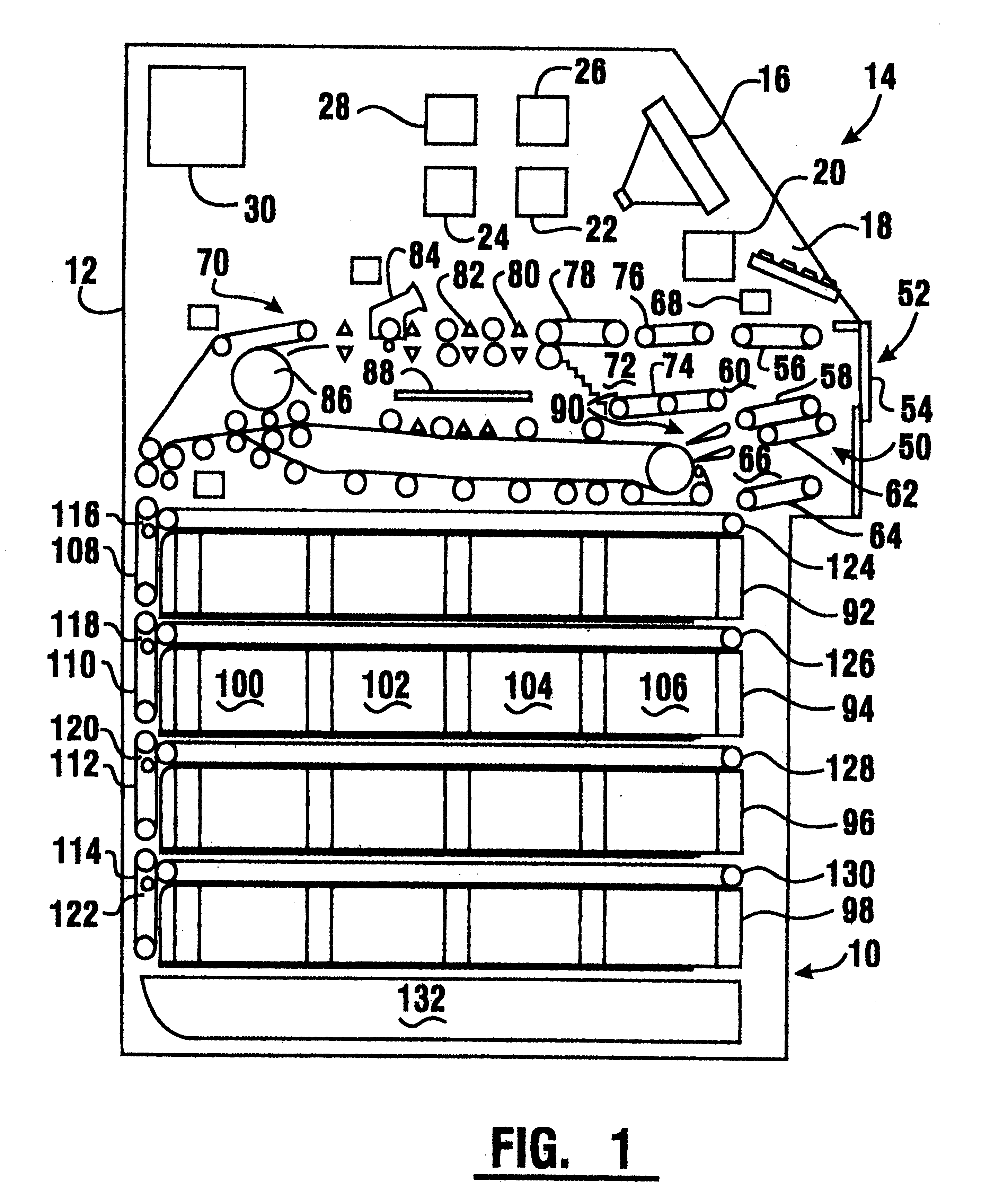

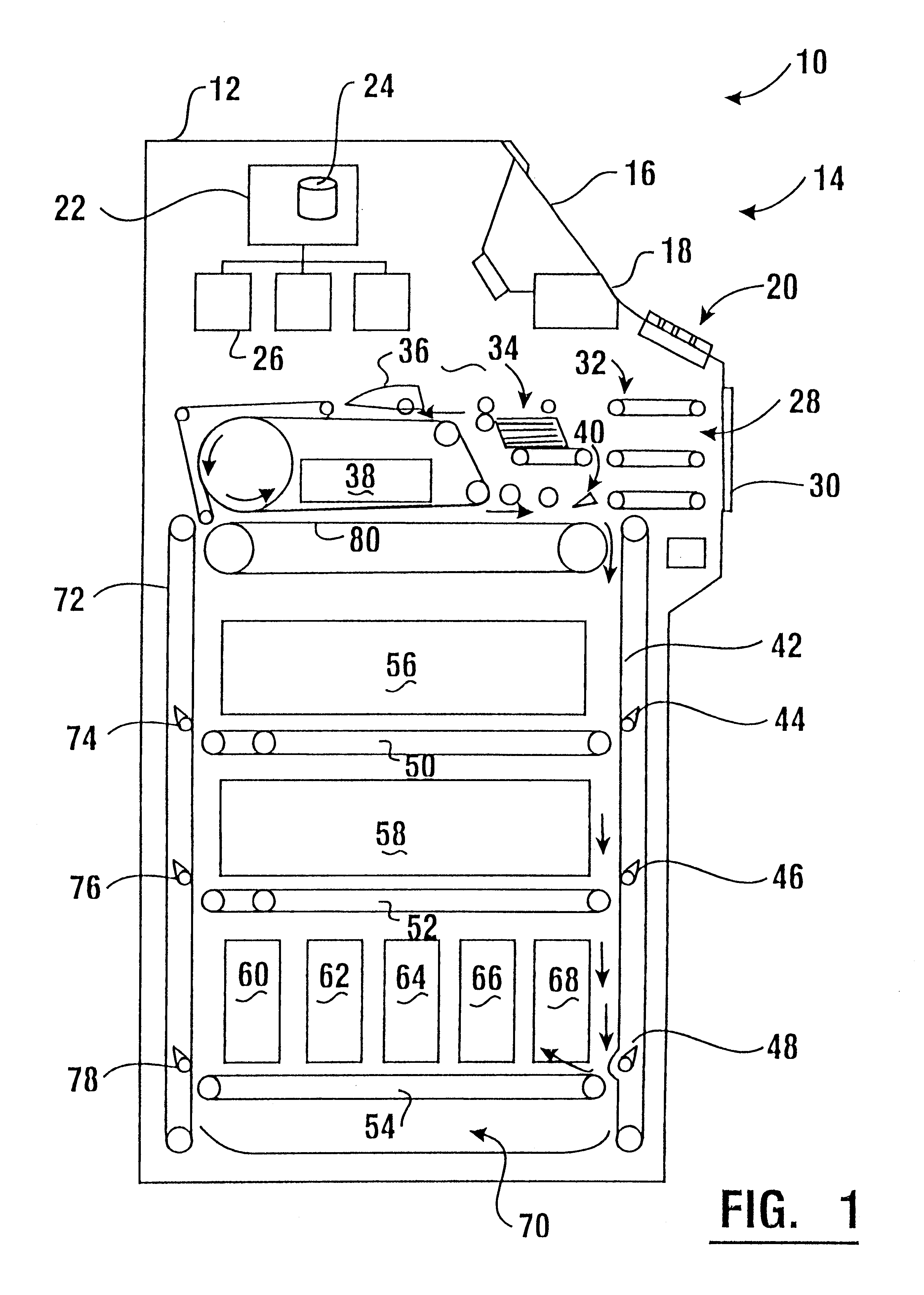

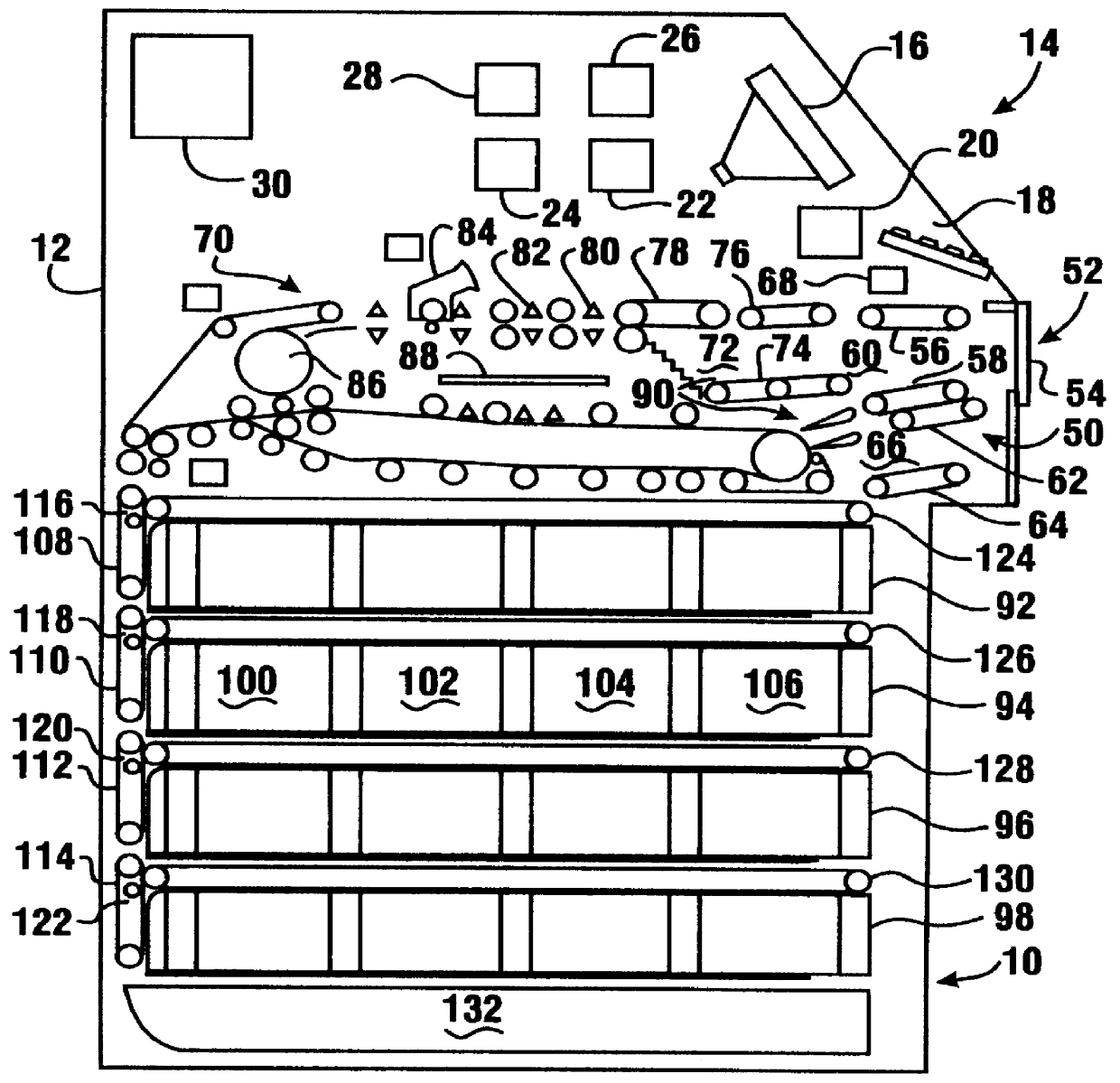

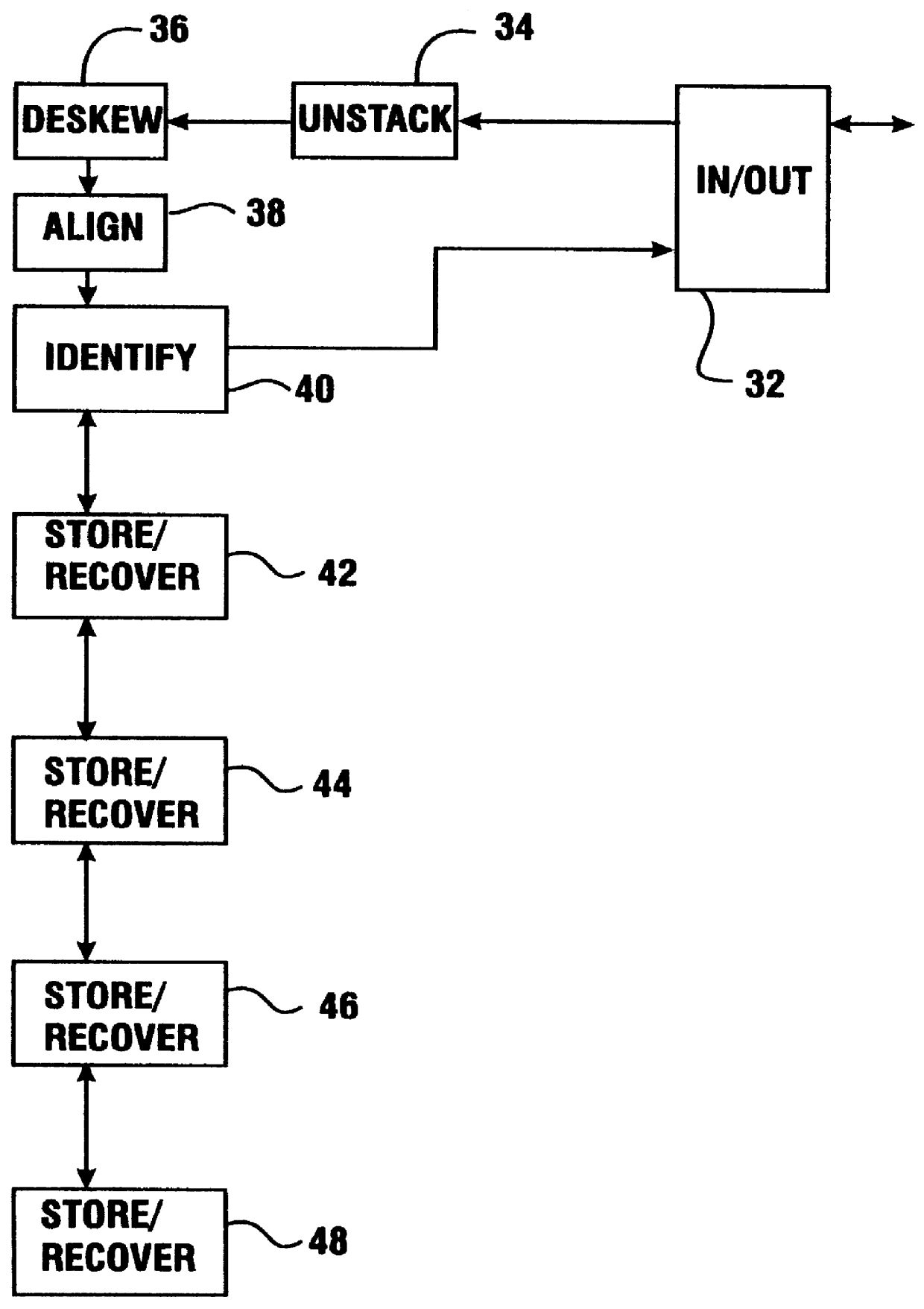

Automated banking machine with self auditing capabilities and system

InactiveUS6109522AEasy to operateRisk minimizationPayment architectureSpecial data processing applicationsMachine selectionDocumentation

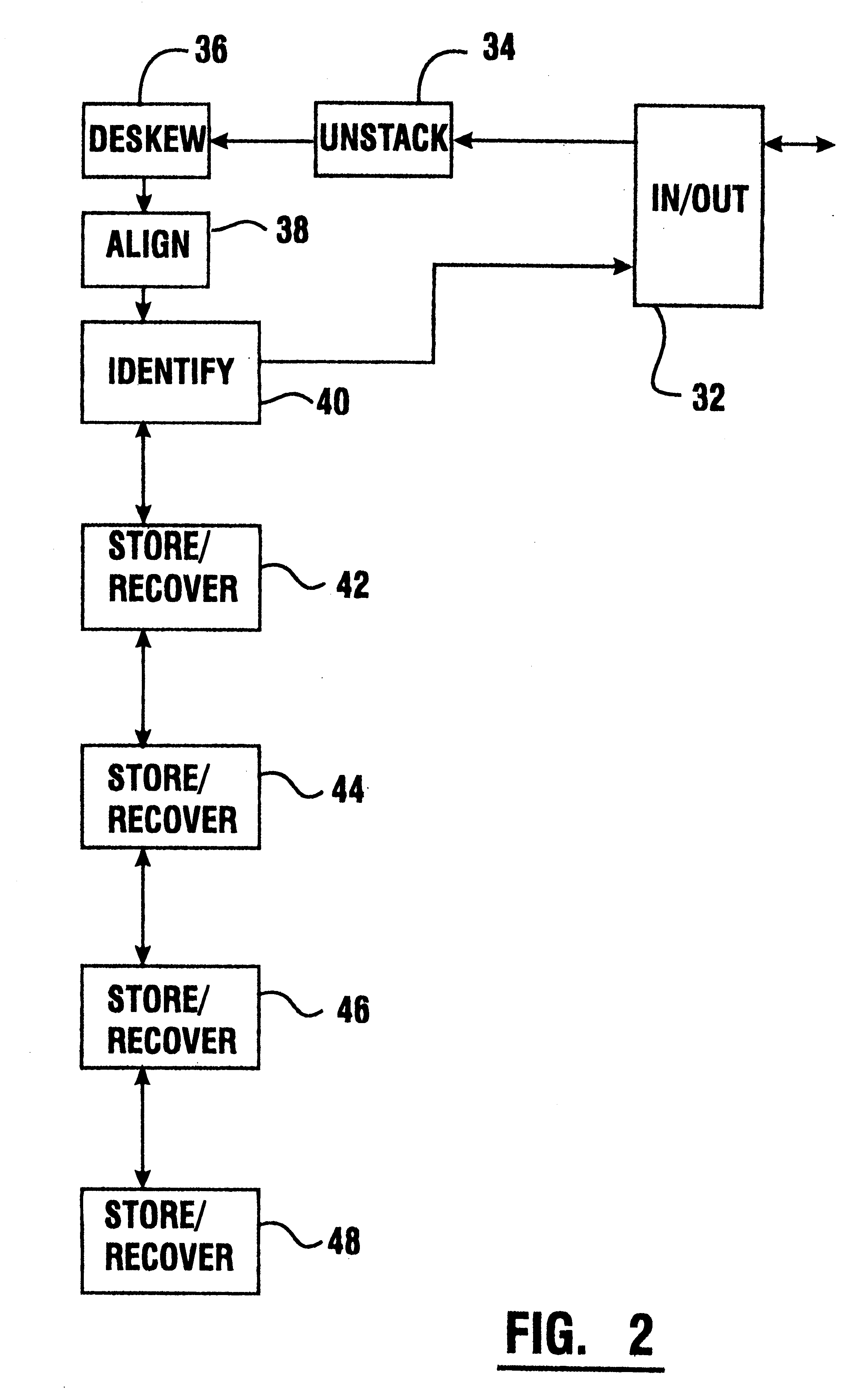

An automated banking machine (10) identifies and stores in storage areas documents such as currency bills deposited by a user. The machine selectively recovers such documents from storage areas and dispenses them. The machine includes a central transport (70) wherein documents deposited in a stack are unstacked, oriented and identified. Such documents are then routed to storage areas in canisters (92, 94, 96, 98). Documents in the storage areas are selectively picked therefrom and delivered to a user through an input / output area (50) of the machine. Each canister includes a memory (626) which holds information concerning the number and type of documents housed in the canister as well as other information concerning the hardware and software resident on the canister. The memory also includes data representative of individuals responsible for loading and transporting the canister. The machine conducts self-auditing activities to verify that the documents held in the storage areas correspond to the information stored in memory and indicate discrepancies.

Owner:DIEBOLD NIXDORF

Currency bill tracking system

A system and method is presented for tracking and tracing currency bills involved in deposit and withdrawal transactions. A transaction identifier is obtained. Currency bills involved in the transaction are scanned in order to obtain their serial numbers. The serial numbers are then linked to the transaction identifier.

Owner:CUMMINS-ALLISON CORP

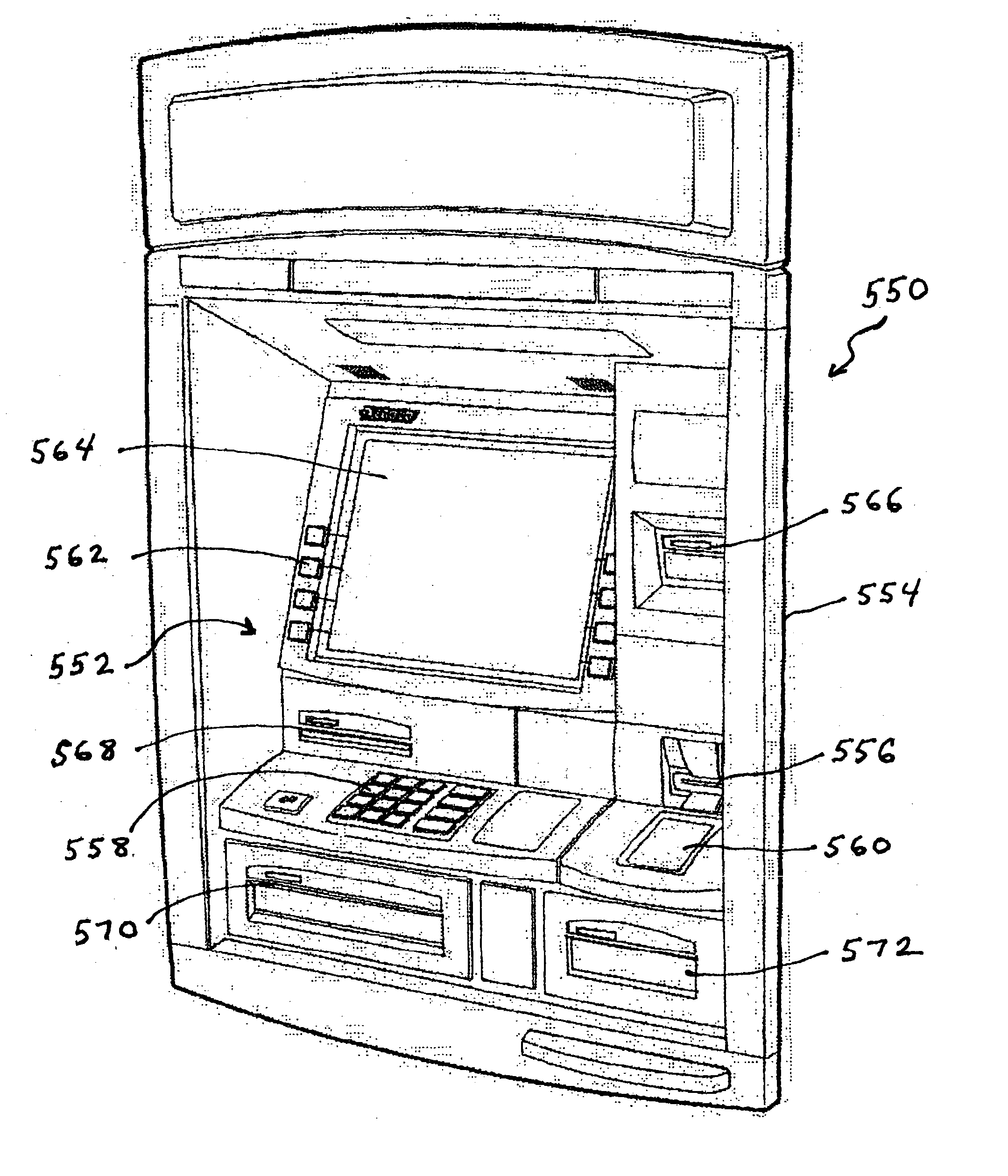

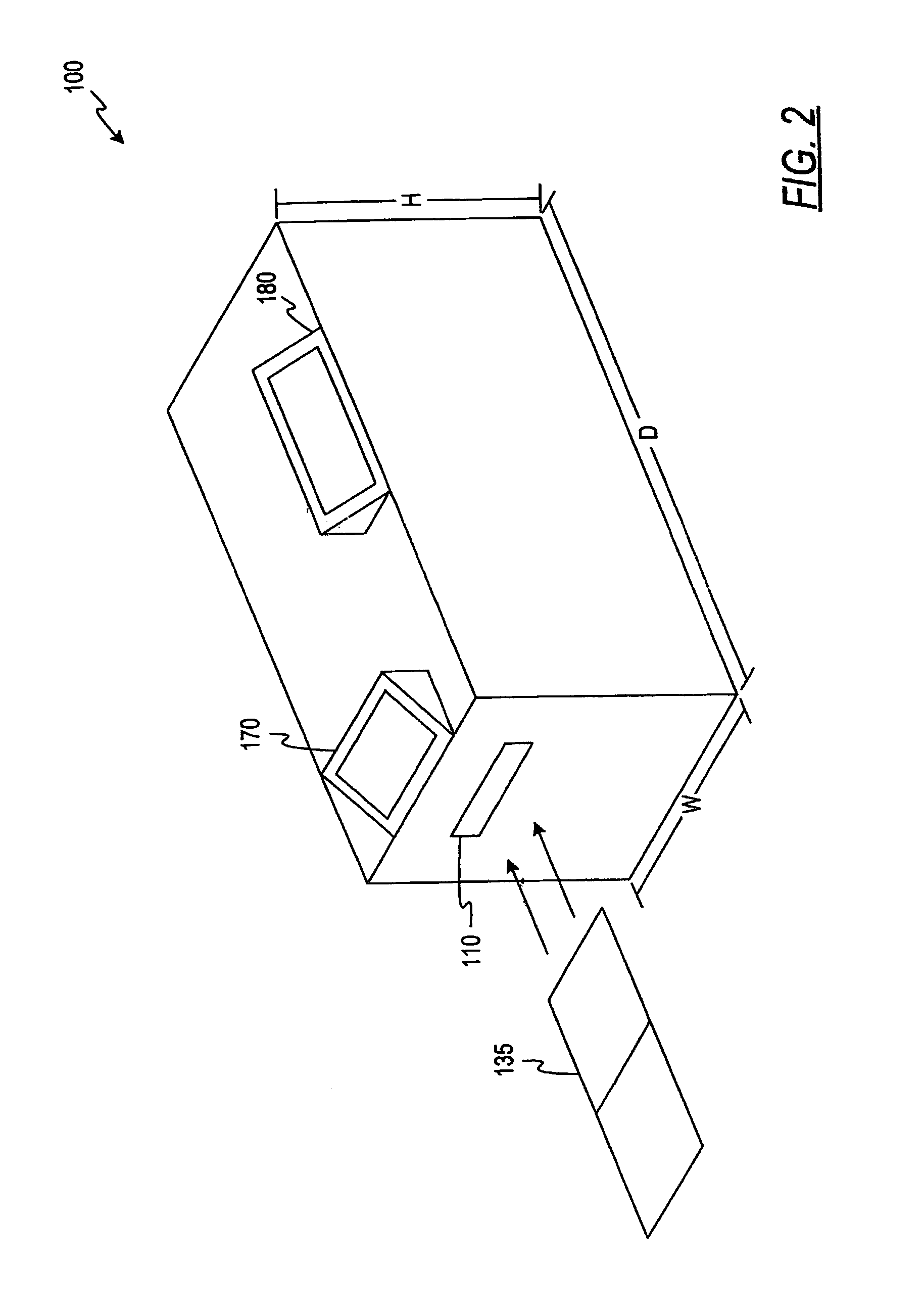

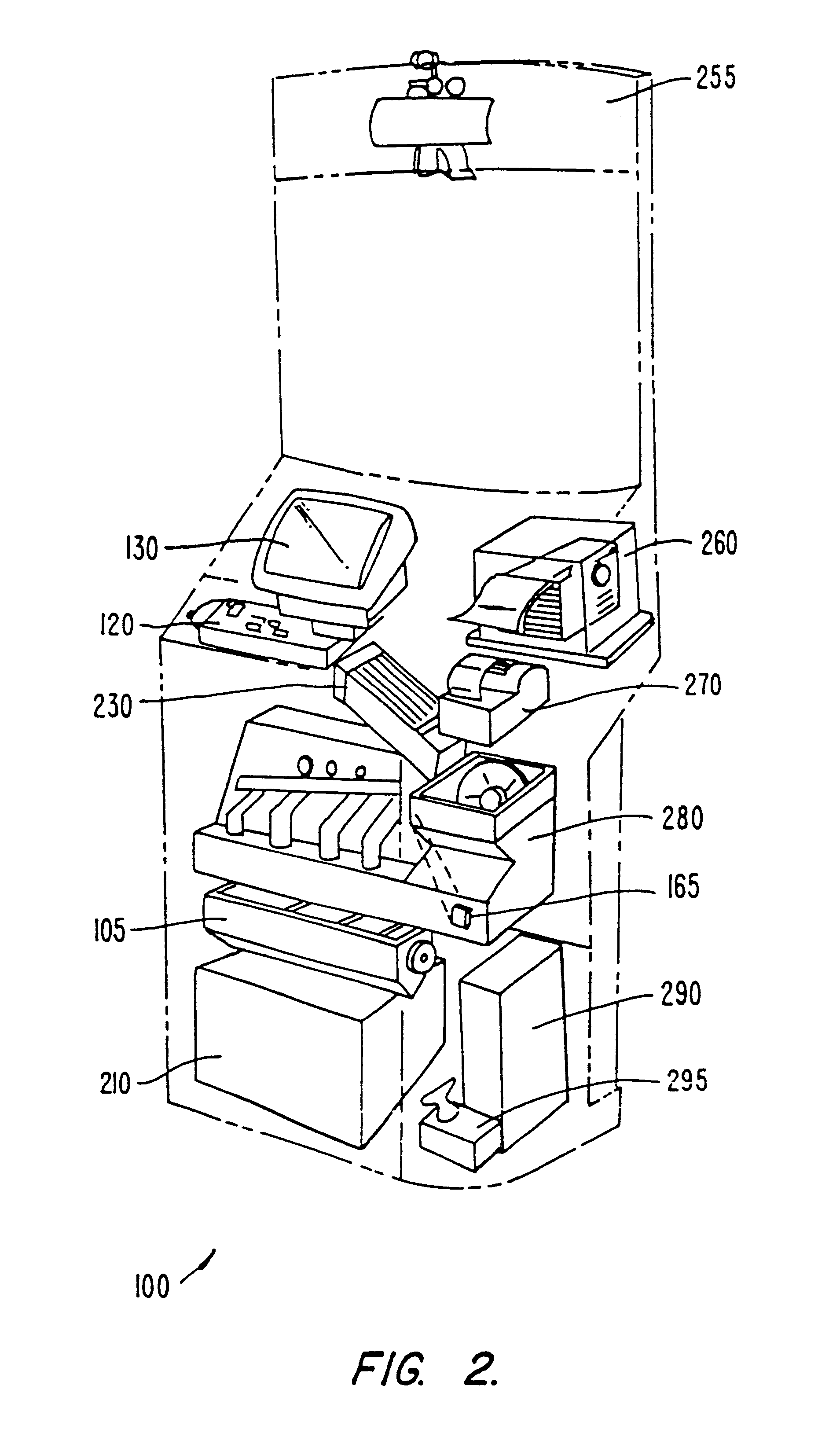

Automated merchant banking apparatus and method

InactiveUS6230928B1Good user interfaceAccurate specificationsComplete banking machinesRacksOutput deviceBiomedical engineering

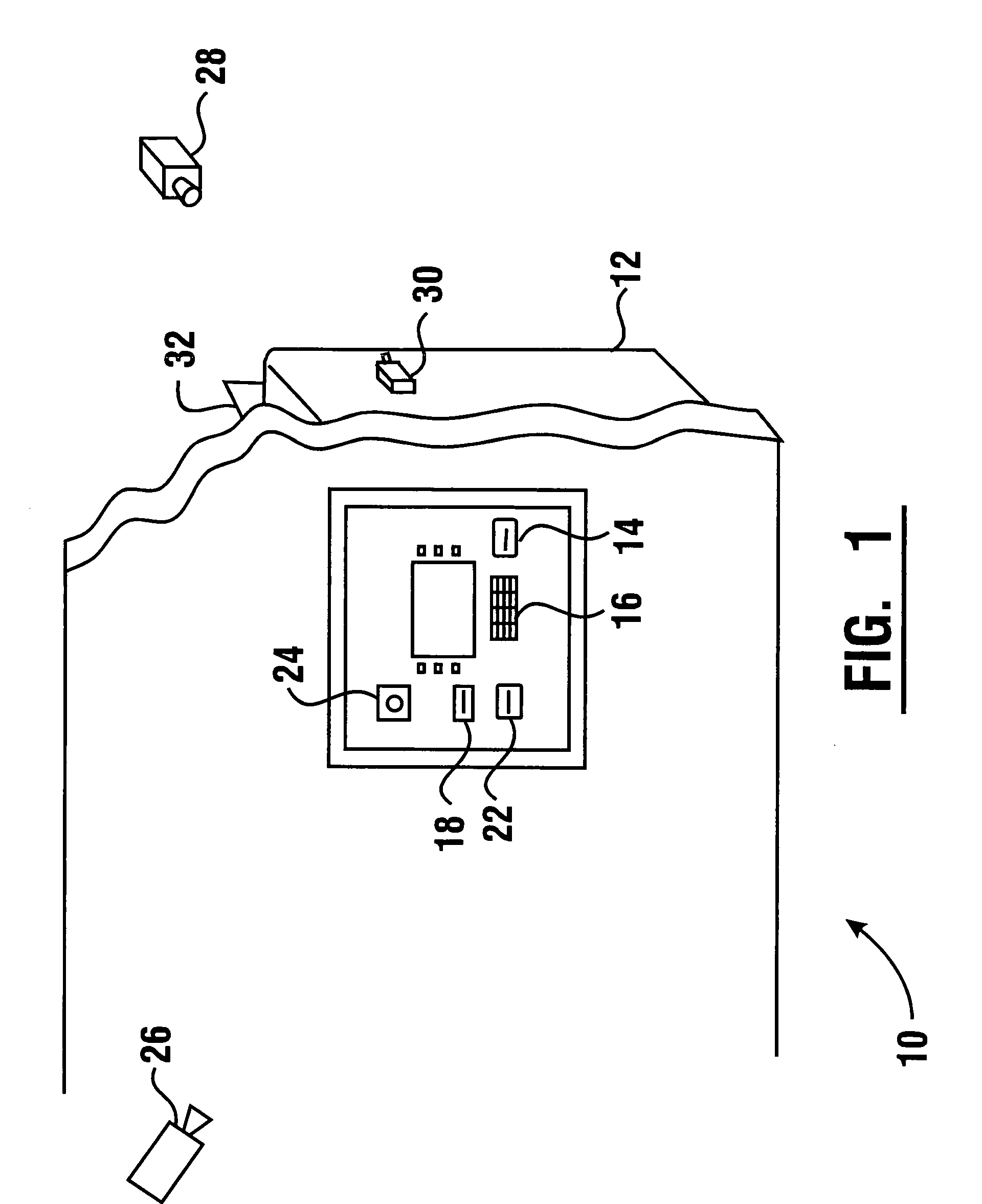

An automated merchant banking apparatus (10) is operative to carry out banking transactions commonly required by merchants. The apparatus includes a user interface (18) which includes a plurality of input and output devices. The apparatus further includes a rolled coin dispenser (40) for dispensing various denominations of rolled coin. The rolled coin dispenser includes a coin roll presenter and retraction unit (42) which is operative to retract coin rolls which have been dispensed into holding areas (177) into a storage area (176) in the machine.

Owner:DIEBOLD NIXDORF

Multiple denomination currency receiving and prepaid card dispensing method and apparatus

InactiveUS6659259B2Digital data processing detailsCounters with additional facilitiesSmart cardDebit card

Owner:DATAWAVE SYST

Currency handling system having multiple output receptacles

InactiveUS6994200B2Paper-money testing devicesRegistering/indicating working of machinesEngineeringHandling system

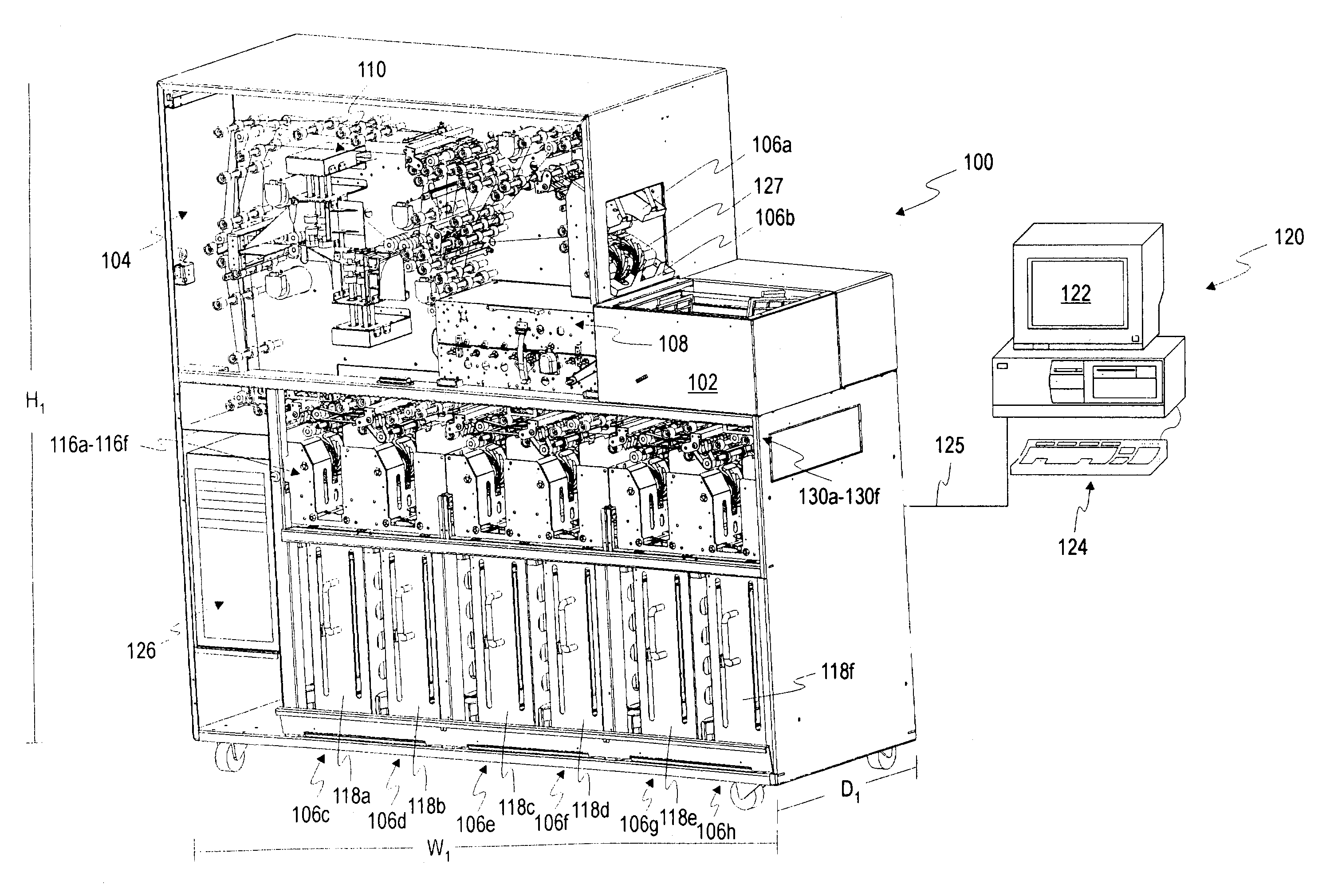

A method and apparatus for handling bill jams within a currency processing device is provided. The device includes a transport mechanism adapted to transport bills along a transport path, one at a time, from the input receptacle past an evaluation unit into a plurality of output receptacles. At least one of the output receptacles includes a holding area and a storage area. A plurality of bill passage sensors are sequentially disposed along the transport path that are adapted to detect the passage of a bill as each bill is transported past each sensor. An encoder is adapted to produce an encoder count for each incremental movement of the transport mechanism. A controller counts the total number of bills transported into each of the holding areas and the total number of bills moved from a holding area to a corresponding storage area after a predetermined number of bills have been transported into the holding area. The controller tracks the movement of each of the bills along the transport path into each of the holding areas with the plurality of bill passage sensors. The presence of a bill jam is detected when a bill is not transported past one of the plurality of bill passage sensors within a requisite number of encoder counts. The operation of the transport mechanism is suspended upon detection of a bill jam. The bills from each of the holding areas are moved to the corresponding storage areas upon suspension of the operation of the transport mechanism. Remaining bills are then flushed from the transport path after moving the bills from each of the holding areas to the corresponding storage areas upon suspension of the operation of the transport mechanism.

Owner:CUMMINS-ALLISON CORP

System and method for processing currency bills and documents bearing barcodes in a document processing device

A document processing device having an evaluation region disposed along a transport path between an input and output receptacle capable of processing both currency bills and substitute currency media having at least one indicia. The evaluation region includes at least one of a currency detector, a media detector, and an imager for detecting predetermined characteristics of currency bills and substitute currency media. A controller coupled to the evaluation region controls the operation of the document processing device and receives input from and provides information to a user via a control unit. In some embodiments, the document processing device may have any number of output receptacles, and the control unit allows the user to specify which output receptacle receives which type of document. An optional coin sorter may be coupled to the document processing device to allow document and coin processing. The document processing device may be coupled to a network to communicate information to devices linked to the network.

Owner:CUMMINS-ALLISON CORP

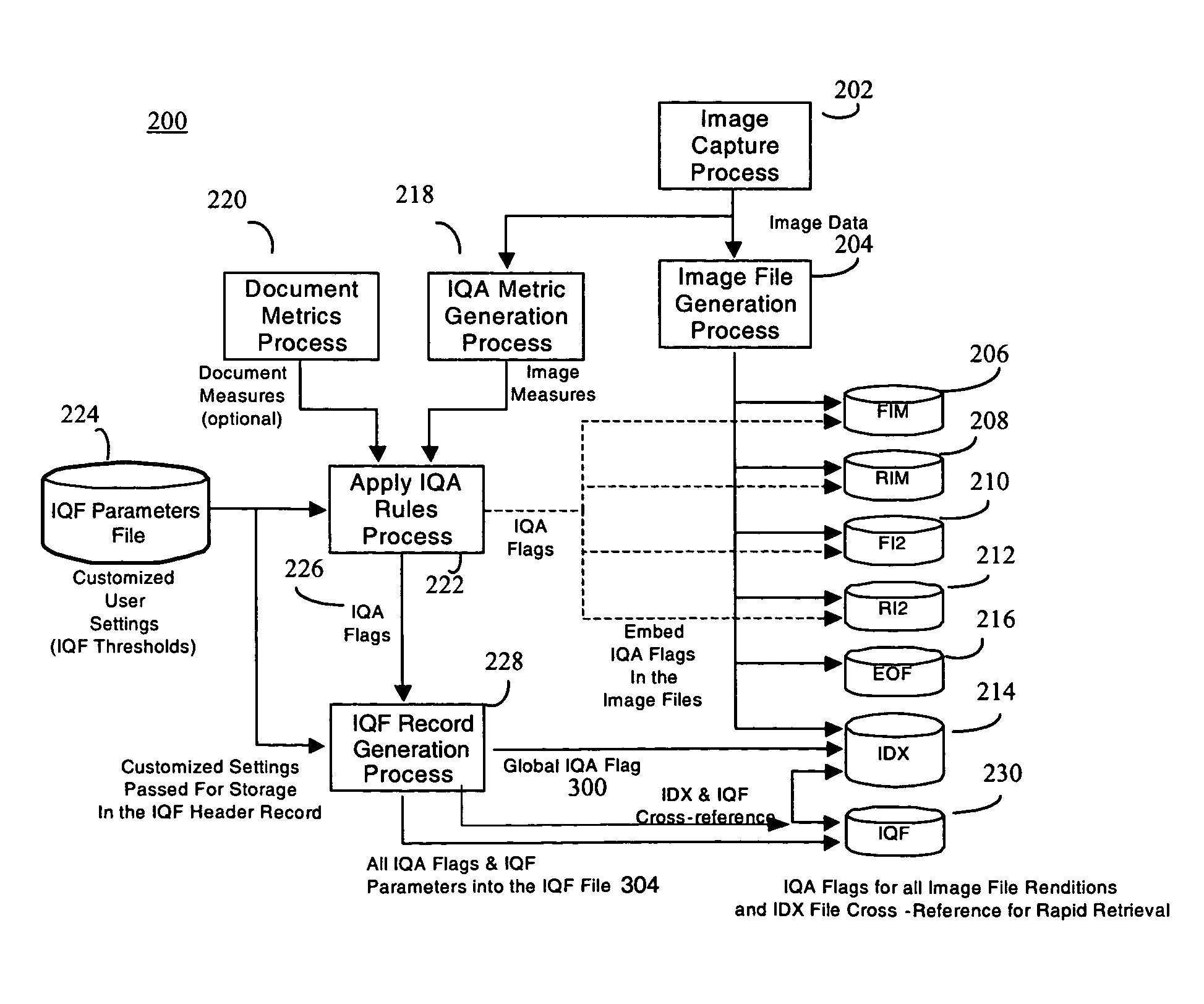

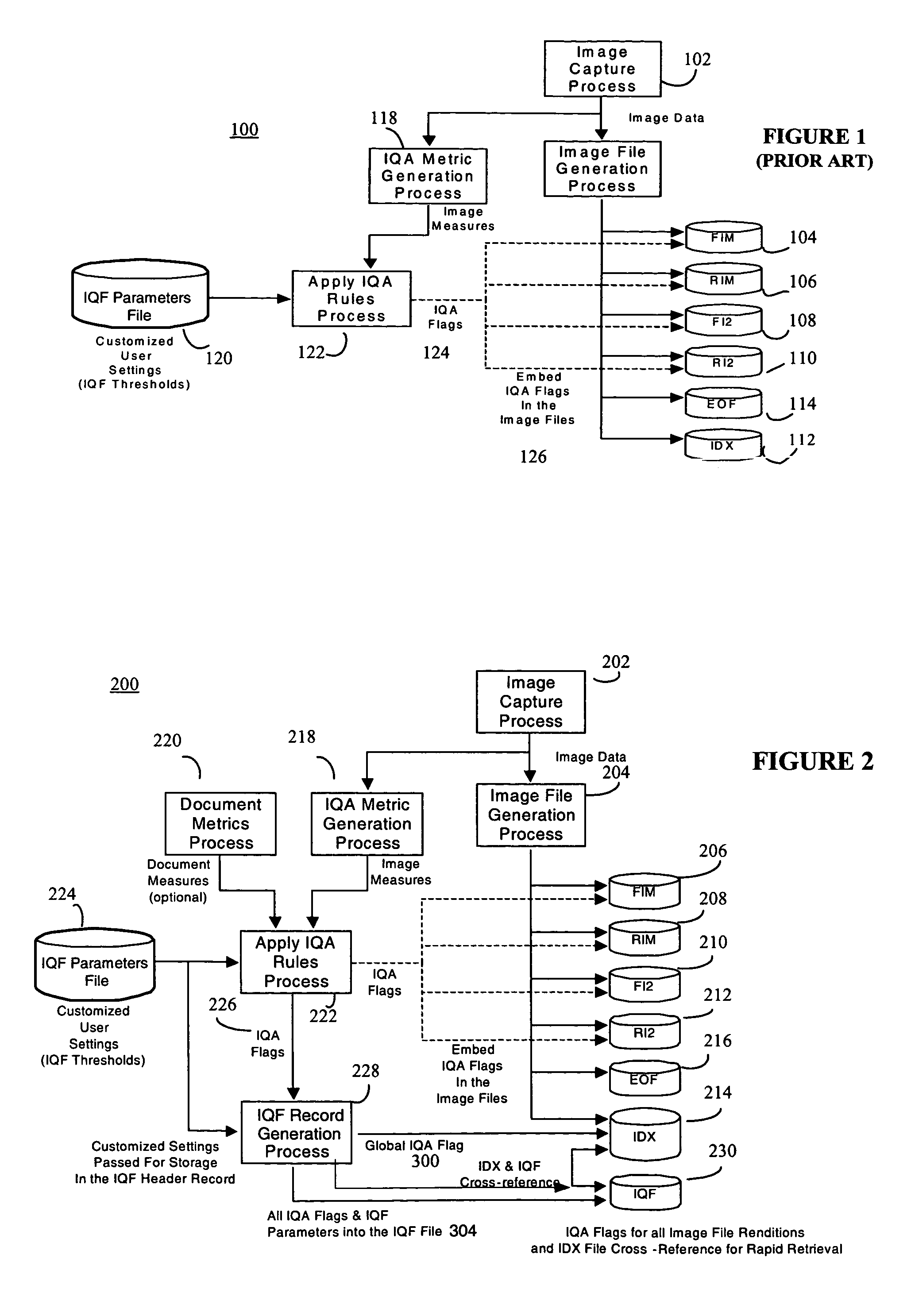

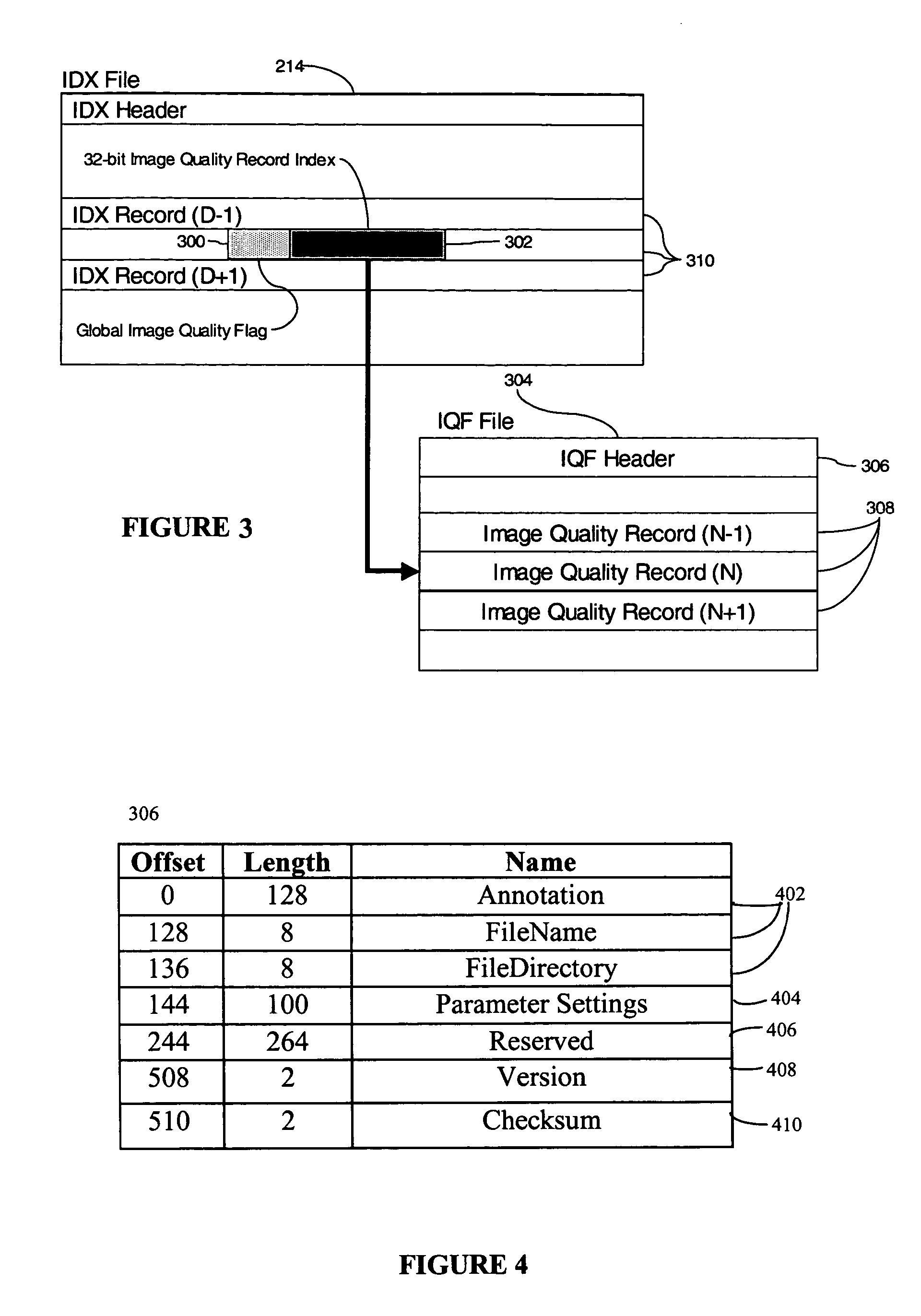

Document processing system with improved image quality assurance

ActiveUS7433098B2Improve image qualityEasy to identifyComplete banking machinesImage enhancementQuality assuranceComputer graphics (images)

A document processing system comprising an image capture subsystem for capturing selected image metrics and at least one image rendition from a plurality of documents and for determining if at least one of the selected image metrics for any of the at least one image rendition does not successfully compare against preselected image quality metric threshold values. An image quality flag is generated for any of the at least one image rendition if it does not successfully compare, and a record entry for each imaged document having at least one flagged image rendition is created in an image quality flag file. An image index file for individually accessing the image renditions is modified to include a reference to the corresponding image quality flag file record entry The document processing system may optionally compare selected document metrics against preselected document metrics in a similar manner. Image defects in the plurality of documents can be identified by examining the record entries in the image quality flag file.

Owner:DIGITAL CHECK CORP

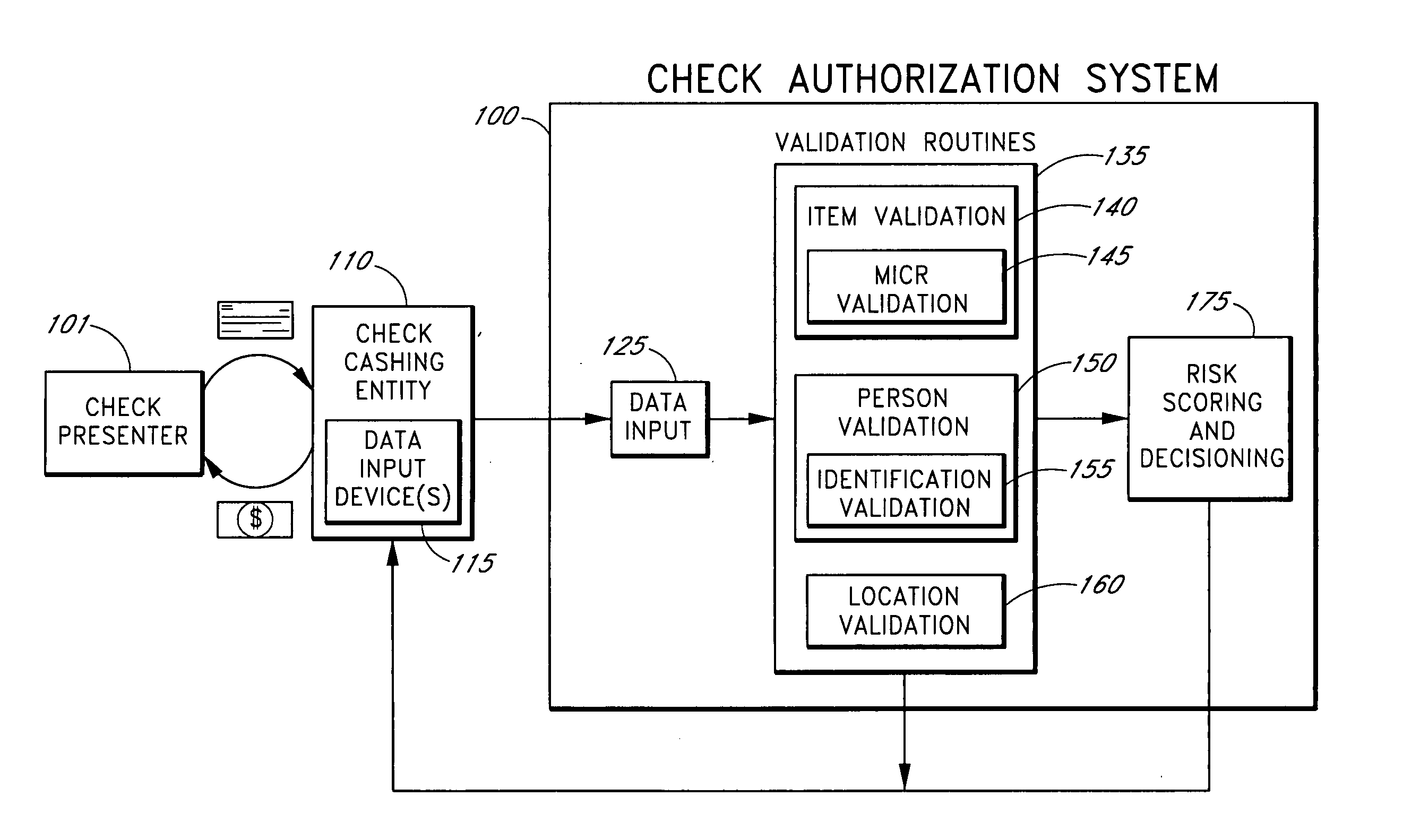

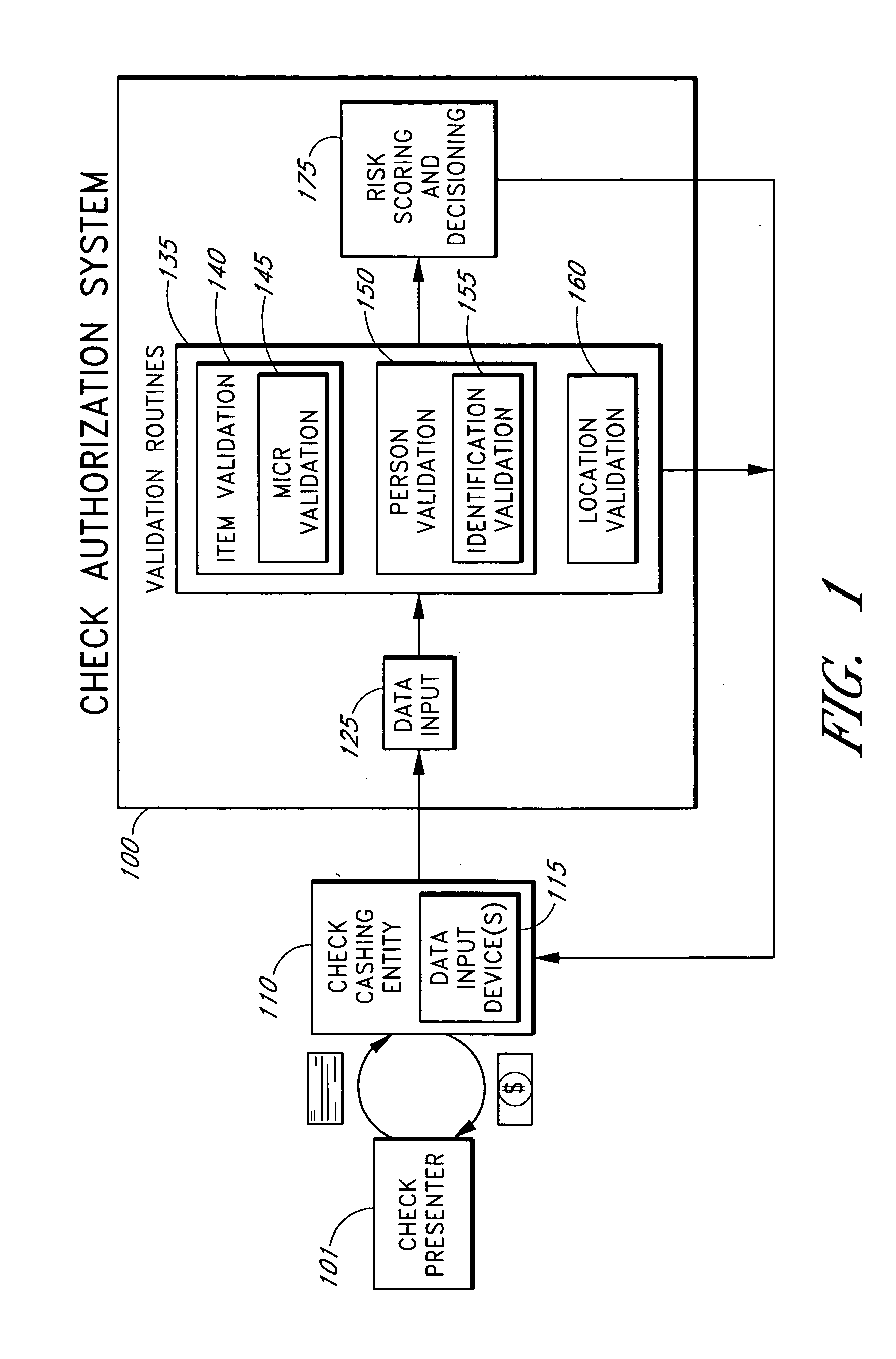

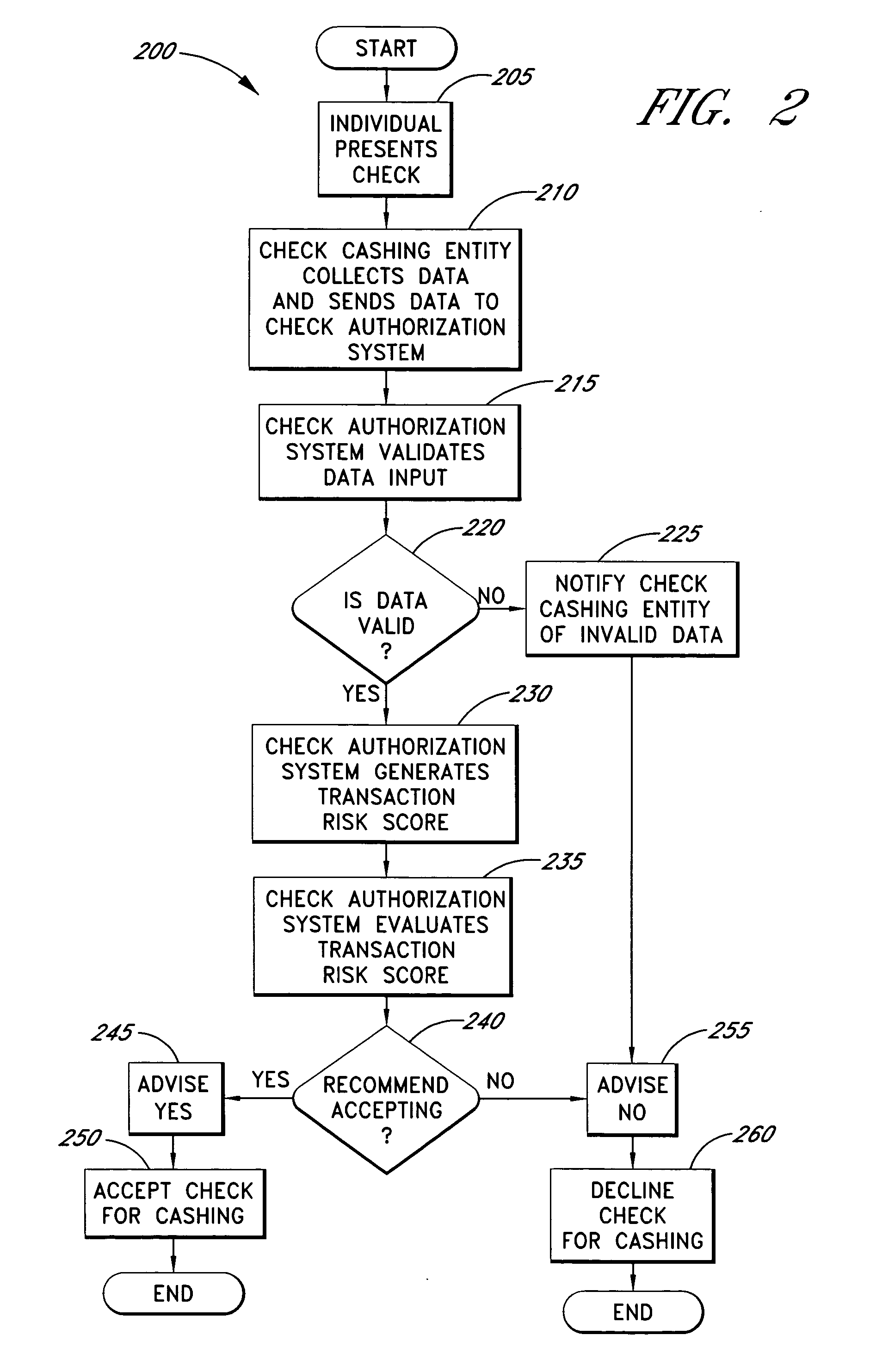

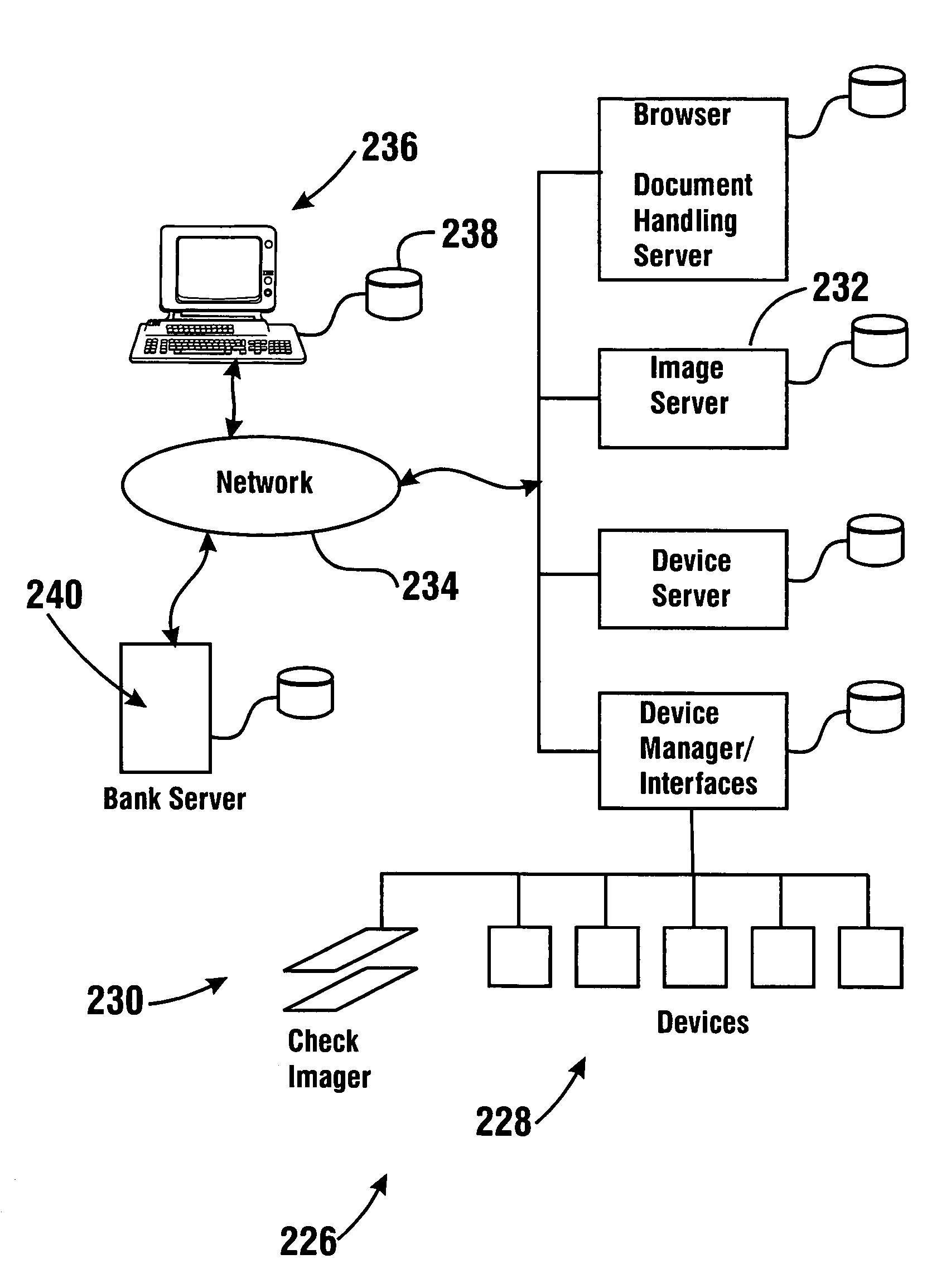

Systems and methods for assessing the risk of financial transaction using geographic-related information

InactiveUS20050125350A1Accurate descriptionSlow processComplete banking machinesFinancePosition dependentCheque

Systems and methods are described for better assessing risk associated with cashing second-party checks and other negotiable instruments. The systems and methods make use of location-related information about an issuer of a second-party check being presented for cashing in order to better assess the legitimacy and cashability of the check. In various embodiments, information about the proximity of the check issuer to the check cashing location is used to enhance risk assessment of the check item. In various embodiments, location-based information about a check may be expressed as a gradated location-based risk score. In various embodiments, the location-based risk score may be combined with risk scores that are descriptive of other aspects of a check cashing transaction to calculate a risk score for the transaction as a whole. In some embodiments, the risk scores may be used to generate an accept / decline recommendation for the transaction.

Owner:FIRST DATA

System and method for capturing and searching image data associated with transactions

ActiveUS7147147B1Easy to detectReduce usageComplete banking machinesFinanceImaging conditionData storing

Owner:DIEBOLD NIXDORF

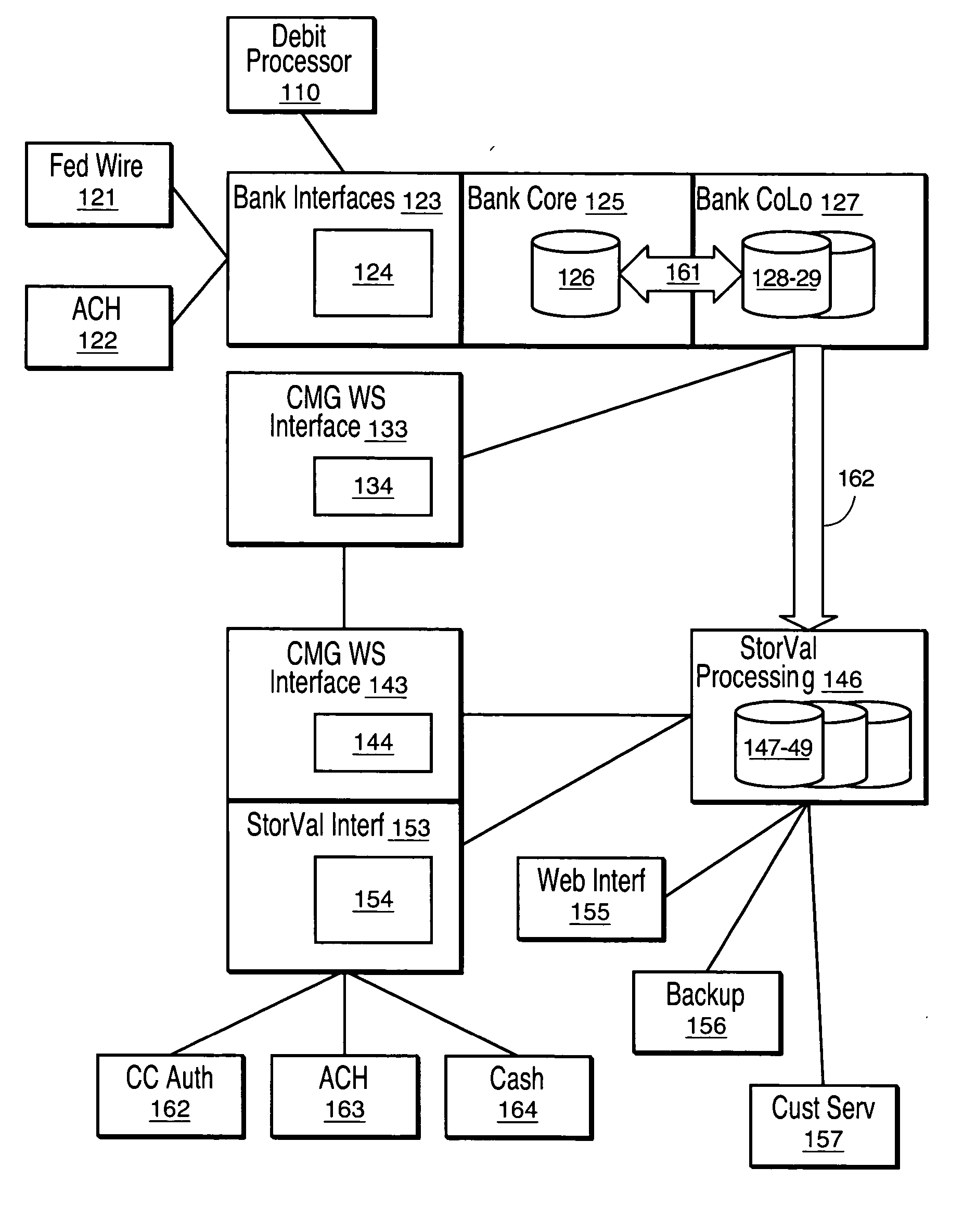

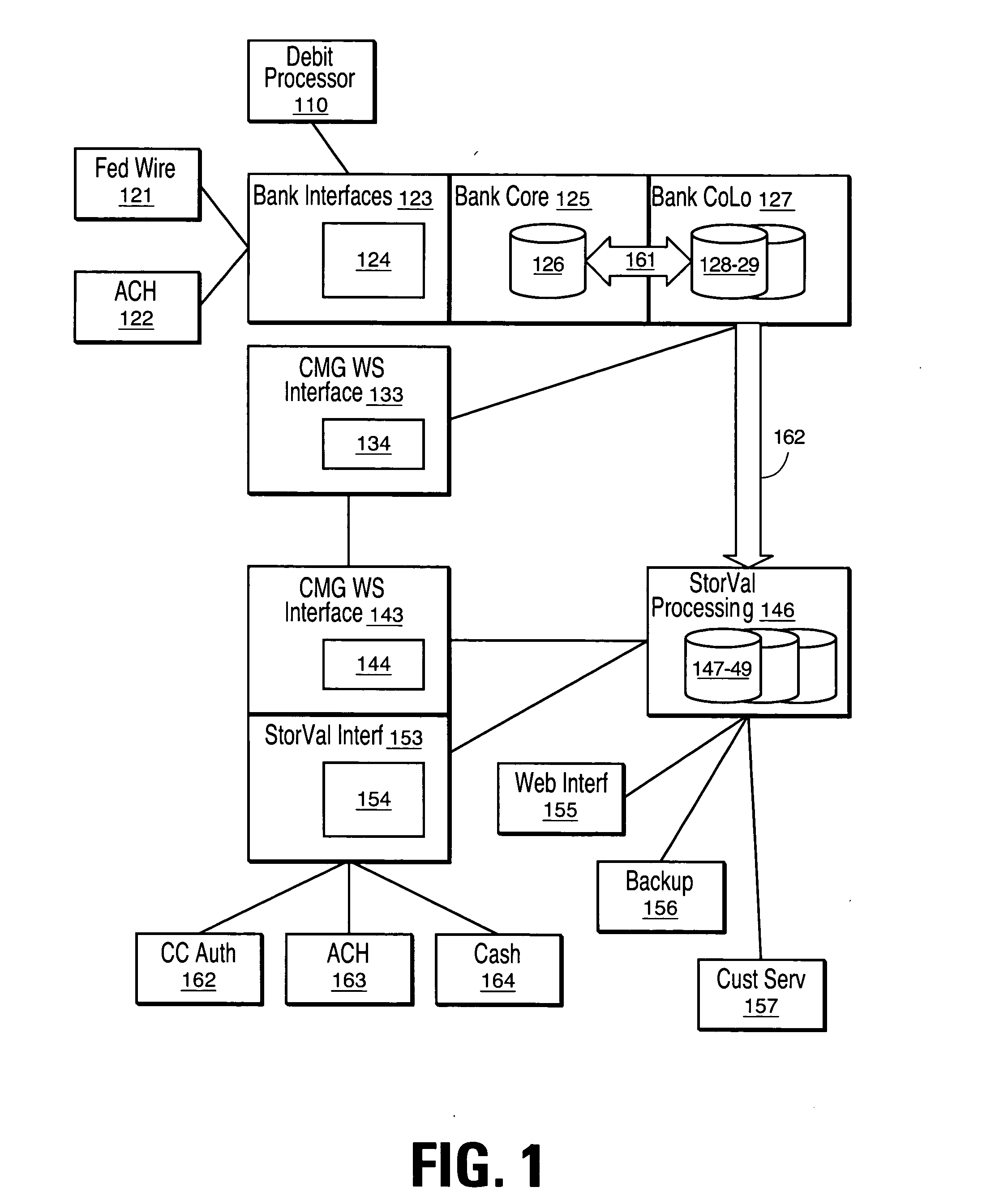

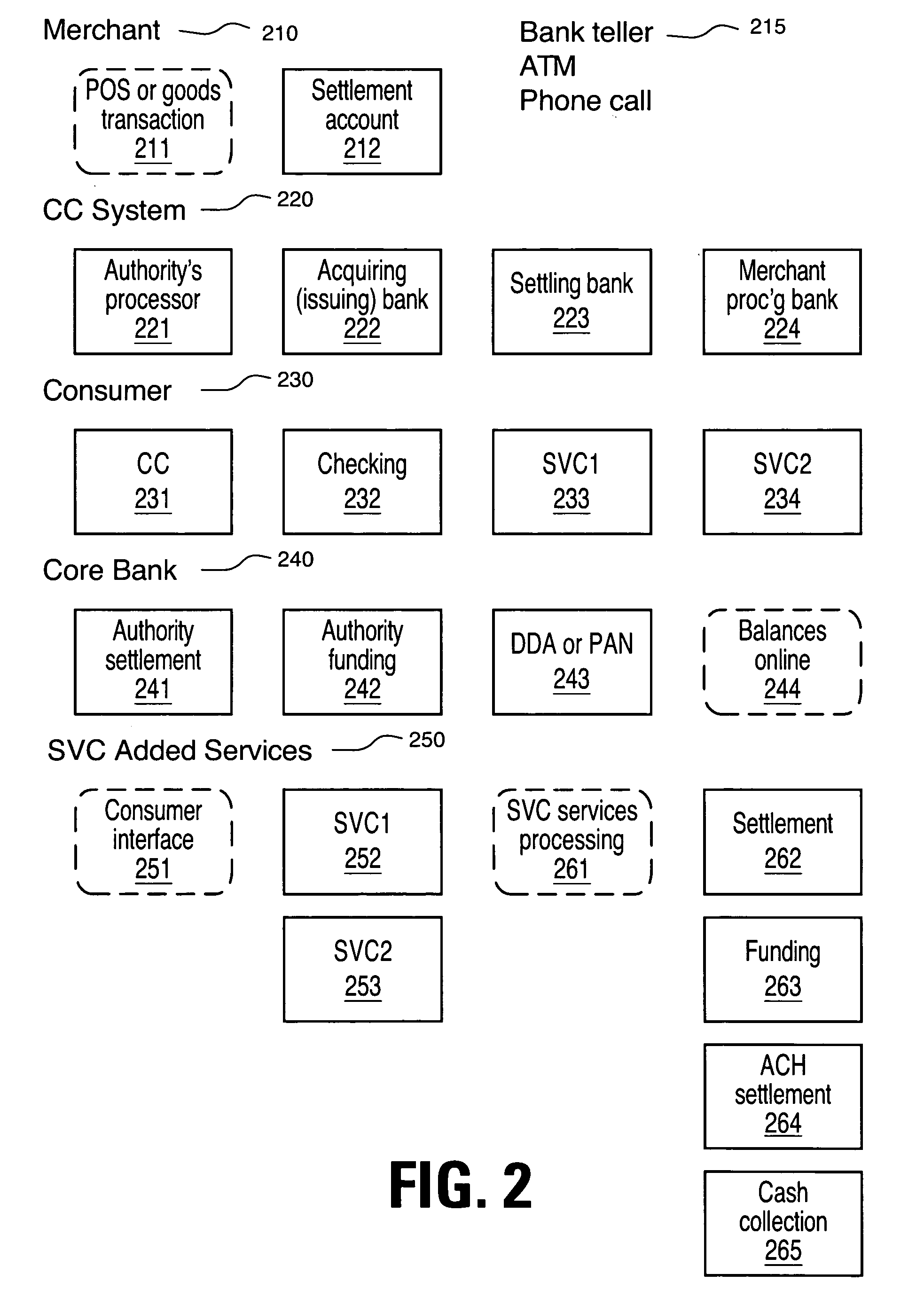

Method and system of detecting cash deposits and attributing value

InactiveUS20060213980A1Improved bank processing systemPrevent fraudComplete banking machinesFinanceOperating systemStored-value card

The present invention relates to stored value cards and improved bank processing systems. In particular, it relates to systems and methods that load value into demand deposit and plastic account number accounts corresponding to the stored value card and make funds available without delay, even for the unbanked. It also relates to methods for avoiding fraud.

Owner:BLUKO INFORMATION GROUP

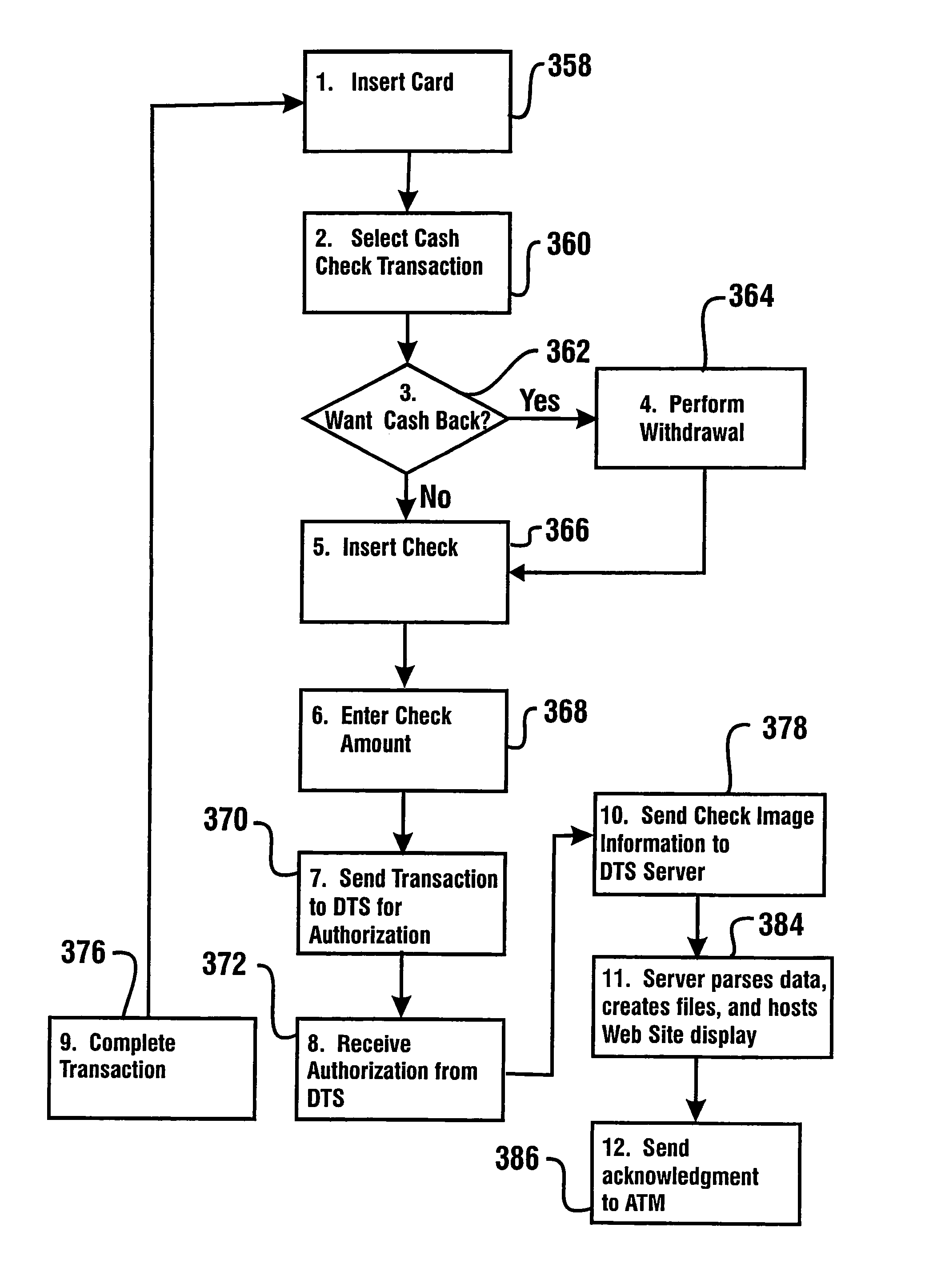

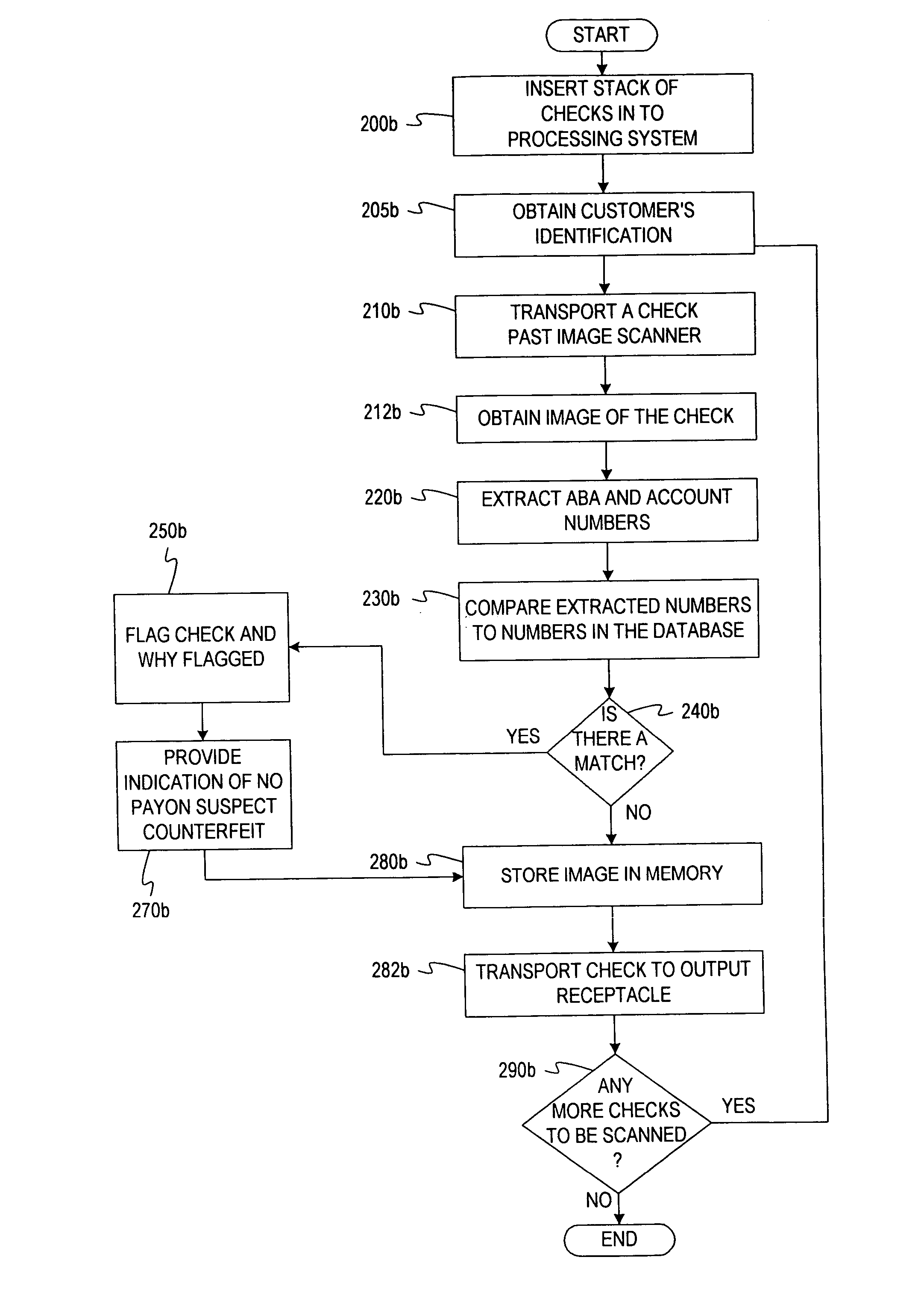

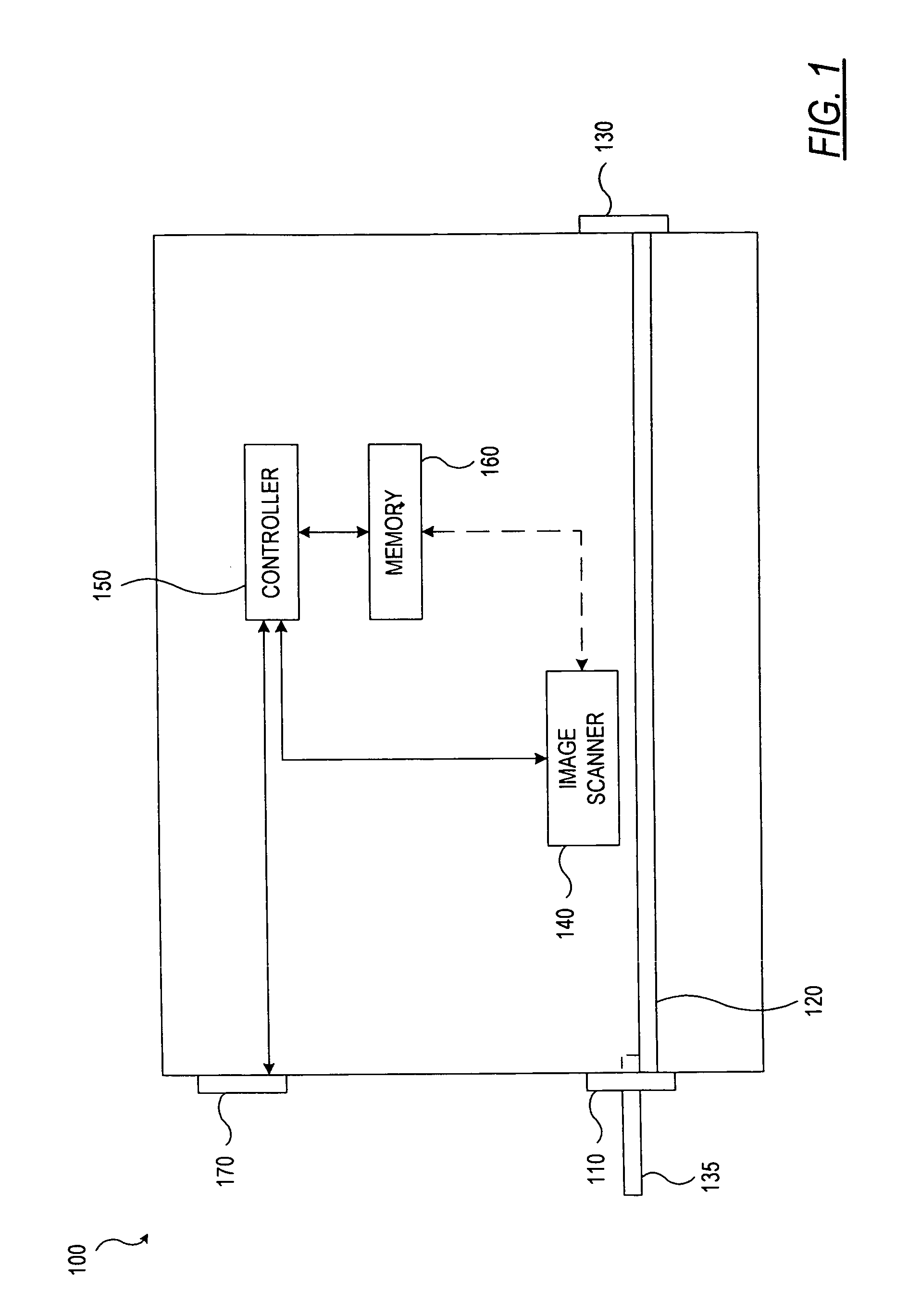

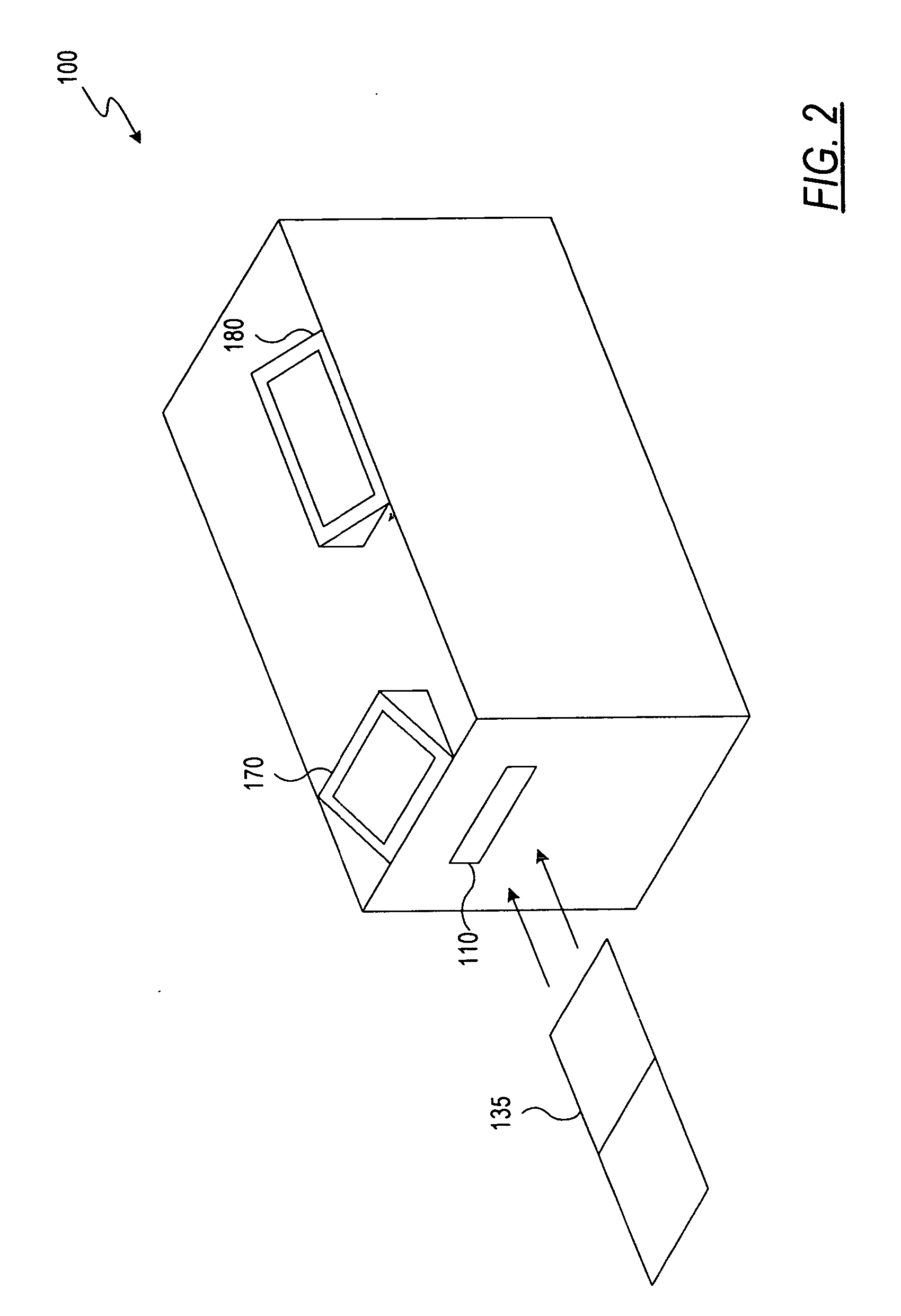

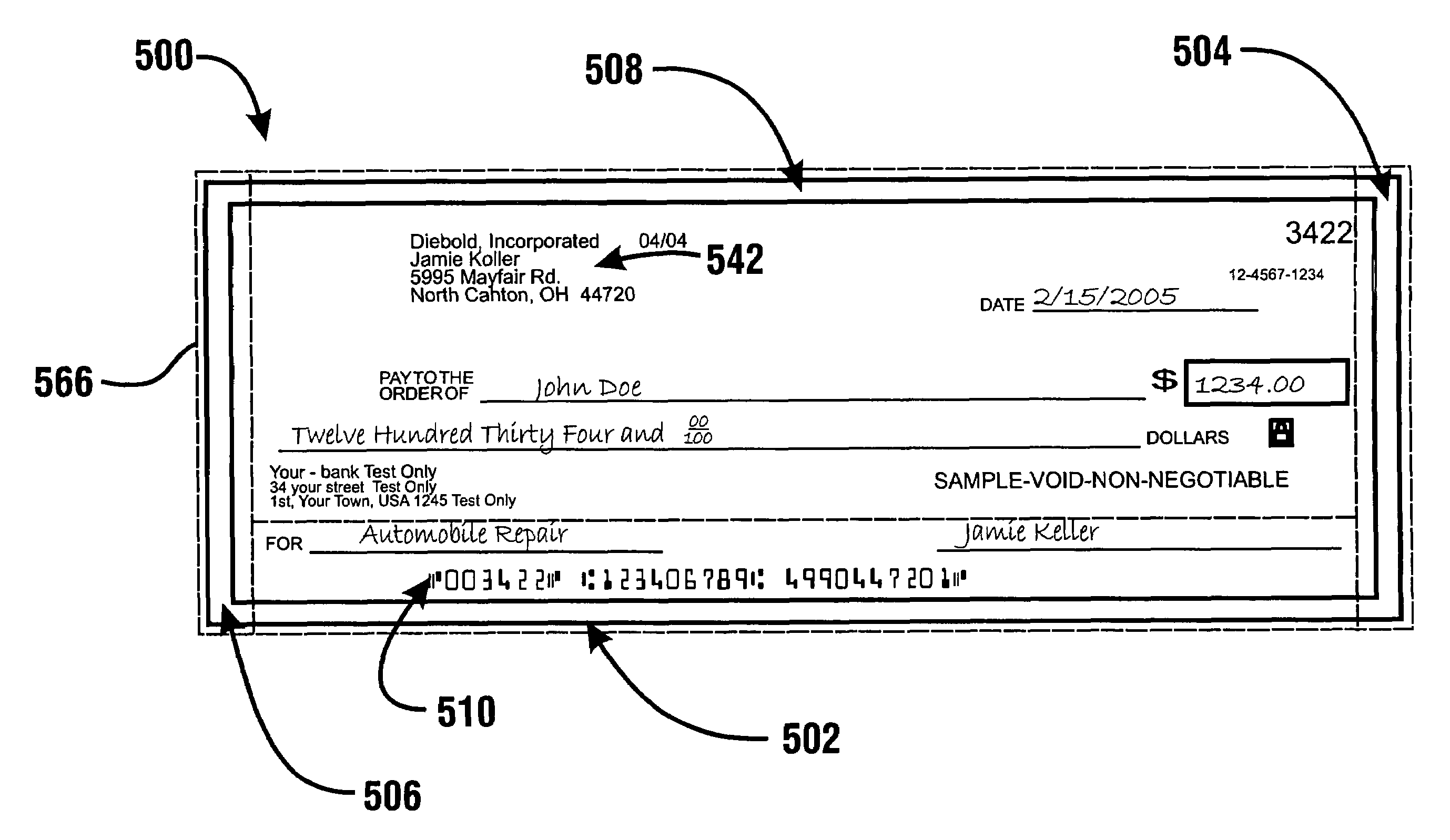

Check accepting and cash dispensing automated banking machine system and method

InactiveUS7140539B1Improve reliabilityReduce the possibilityComplete banking machinesFinanceChequeMachining system

An automated banking machine system and method includes ATMs which accept checks and dispense cash to users. The ATMs are operated to acquire image and magnetic data from deposited checks to determine the genuineness of checks and the authority of a user to receive cash for such checks. Cash may be dispensed to the user from the ATM in exchange for the deposited checks.

Owner:DIEBOLD NIXDORF

Document processing system using full image scanning

Owner:CUMMINS-ALLISON CORP

Method of evaluating checks deposited into a cash dispensing automated banking machine

InactiveUS7494052B1Improve reliabilityReduce riskComplete banking machinesFinanceTransaction dataCheque

An automated banking machine system and method includes ATMs which accept checks and dispense cash to users. The ATMs are operated to acquire image and magnetic data from deposited checks to determine the genuineness of checks and the authority of a user to receive cash for such checks. Cash may be dispensed to the user from the ATM in exchange for the deposited check. The ATMs dispense cash responsive to communications with a transaction host. The transaction host provides transaction identifying data to the ATM. The ATM sends the transaction identifying data and check images to an image and transaction data server for processing.

Owner:DIEBOLD SELF SERVICE SYST DIV OF DIEBOLD NIXDORF INC

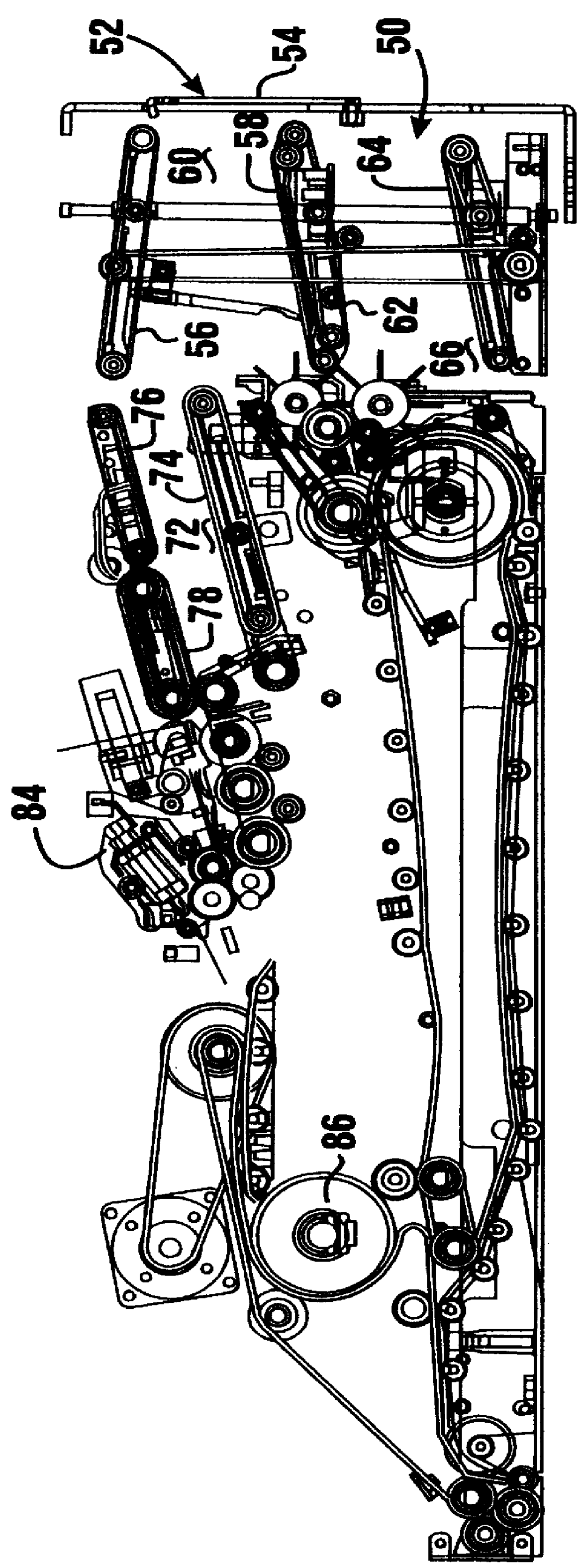

Currency recycling automated banking machine

InactiveUS6290070B1Easy to operateFacilitate rapid operation of machinePayment architectureSortingMachine selectionDocumentation

An automated banking machine (10) identifies and stores documents such as currency bills deposited by a user. The machine then selectively recovers such documents from storage and dispenses them to other users. The machine includes a central transport (70) wherein documents deposited in a stack are unstacked, oriented and identified. Such documents are then routed to storage areas in recycling canisters (92, 94, 96, 98). When a user subsequently requests a dispense, documents stored in the storage areas are selectively picked therefrom and delivered to the user through an input / output area (50) of the machine.

Owner:DIEBOLD NIXDORF

Multiple denomination currency receiving and prepaid card dispensing method and apparatus

InactiveUS20020179401A1Digital data processing detailsCounters with additional facilitiesSmart cardDebit card

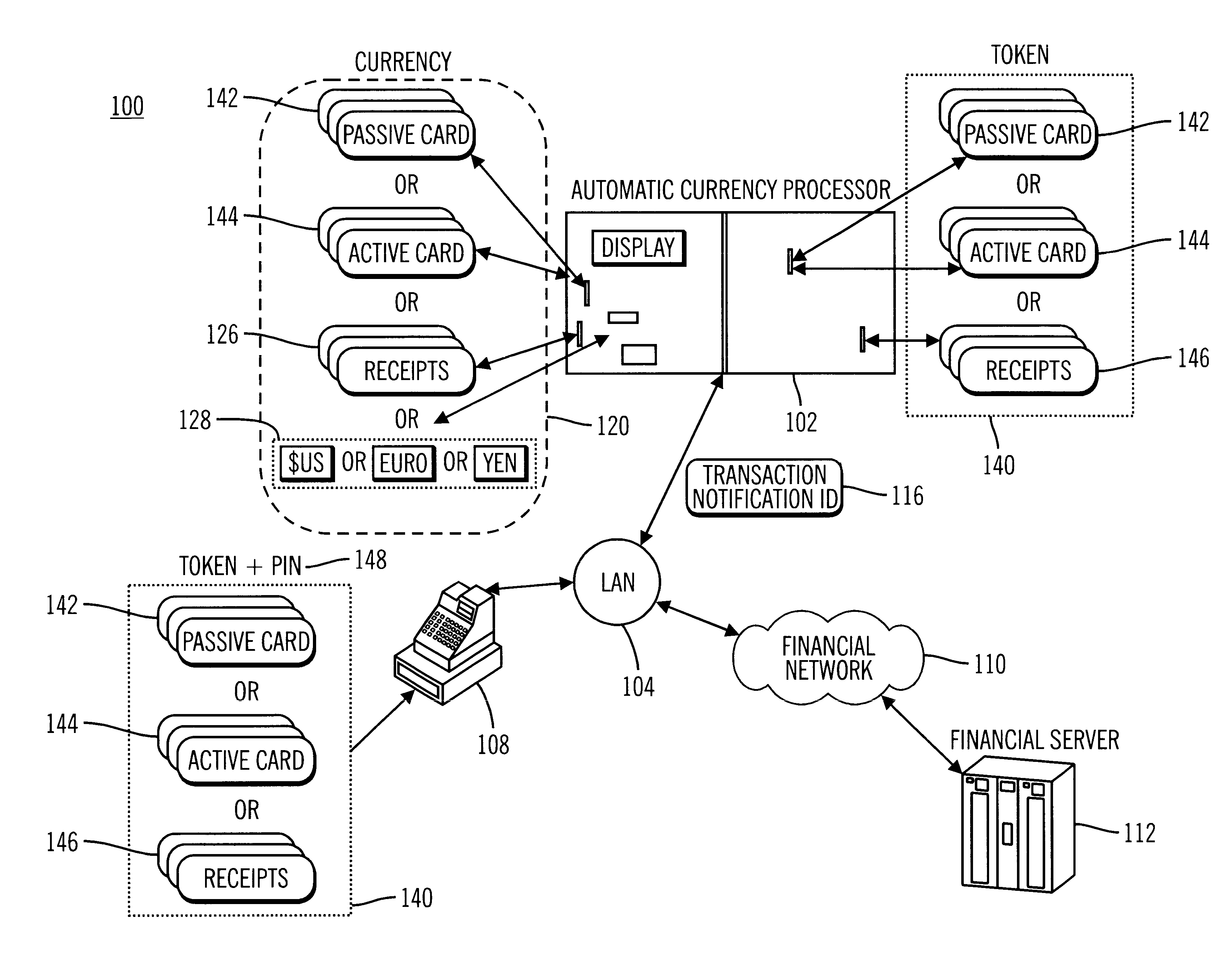

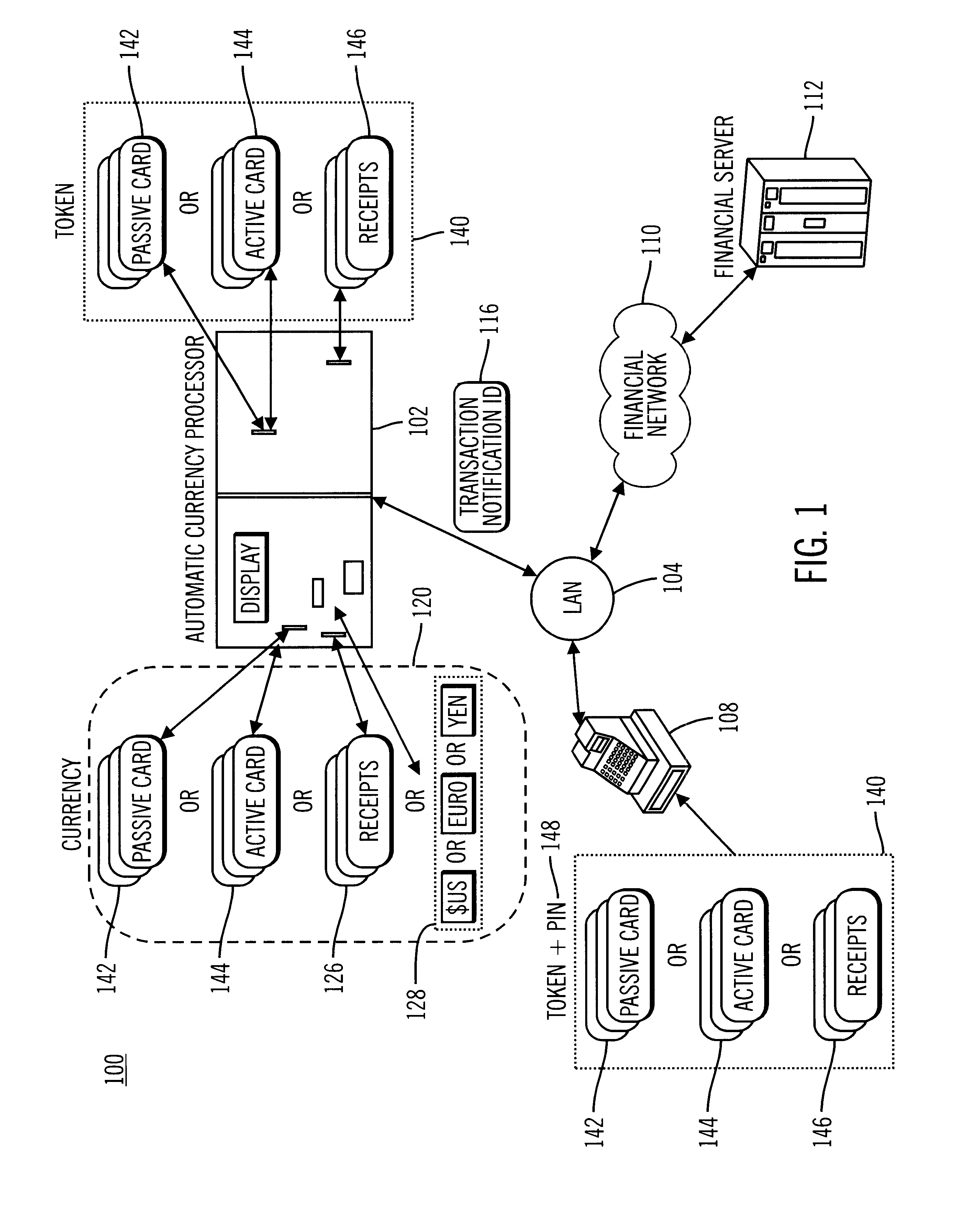

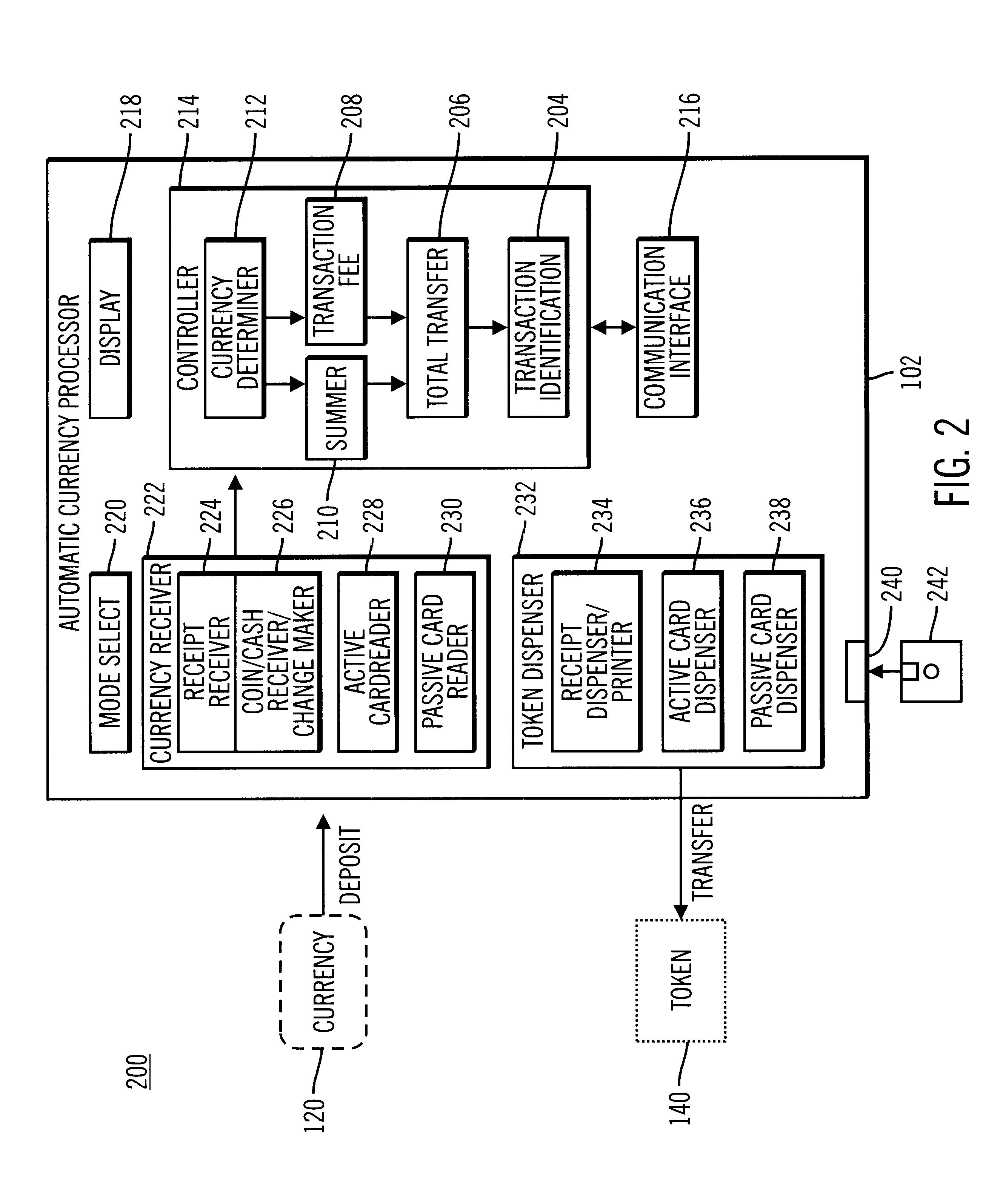

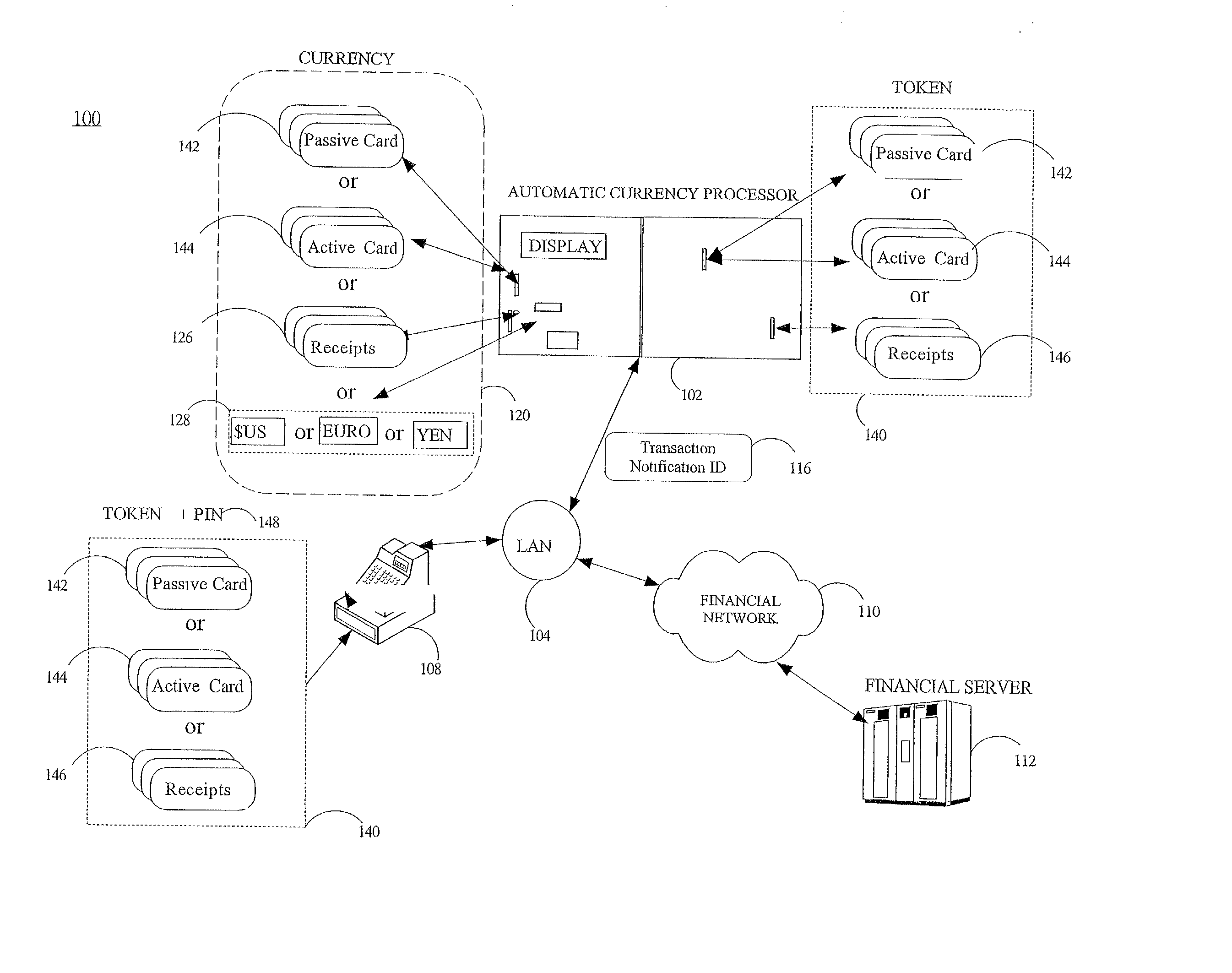

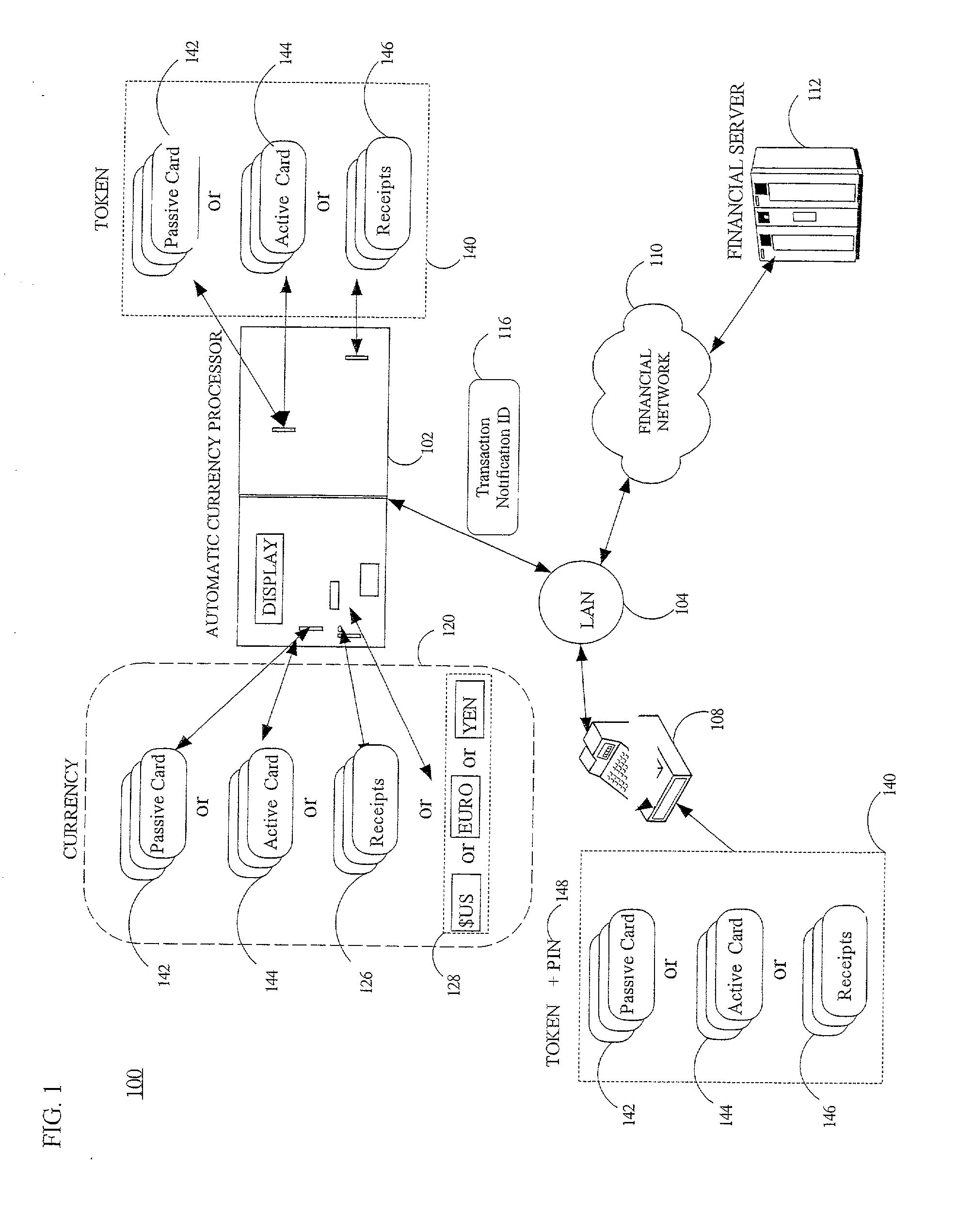

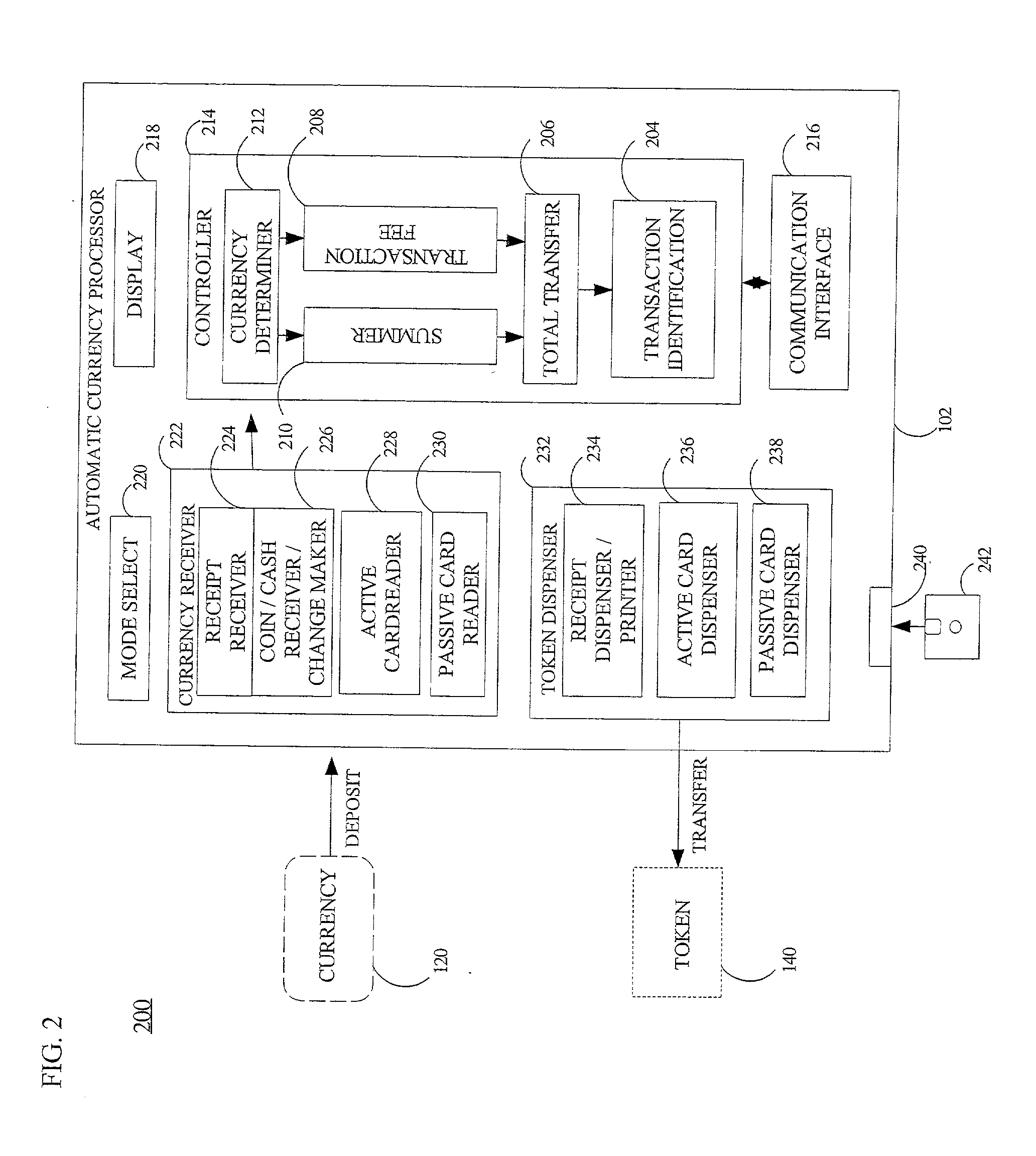

A method and system and computer readable medium for processing currency including cash, coins, passive cards, prepaid cards, debit cards, check cards, and smart cards and for providing tokens including passive cards, debit cards, check cards, and smart cards. A transaction fee is calculated based upon a combination of one more of the following (i) type and amount of currency deposited; (iii) the type and amount of token requested; and (iii) the type and amount of the subsequent purchase.

Owner:DATAWAVE SYST

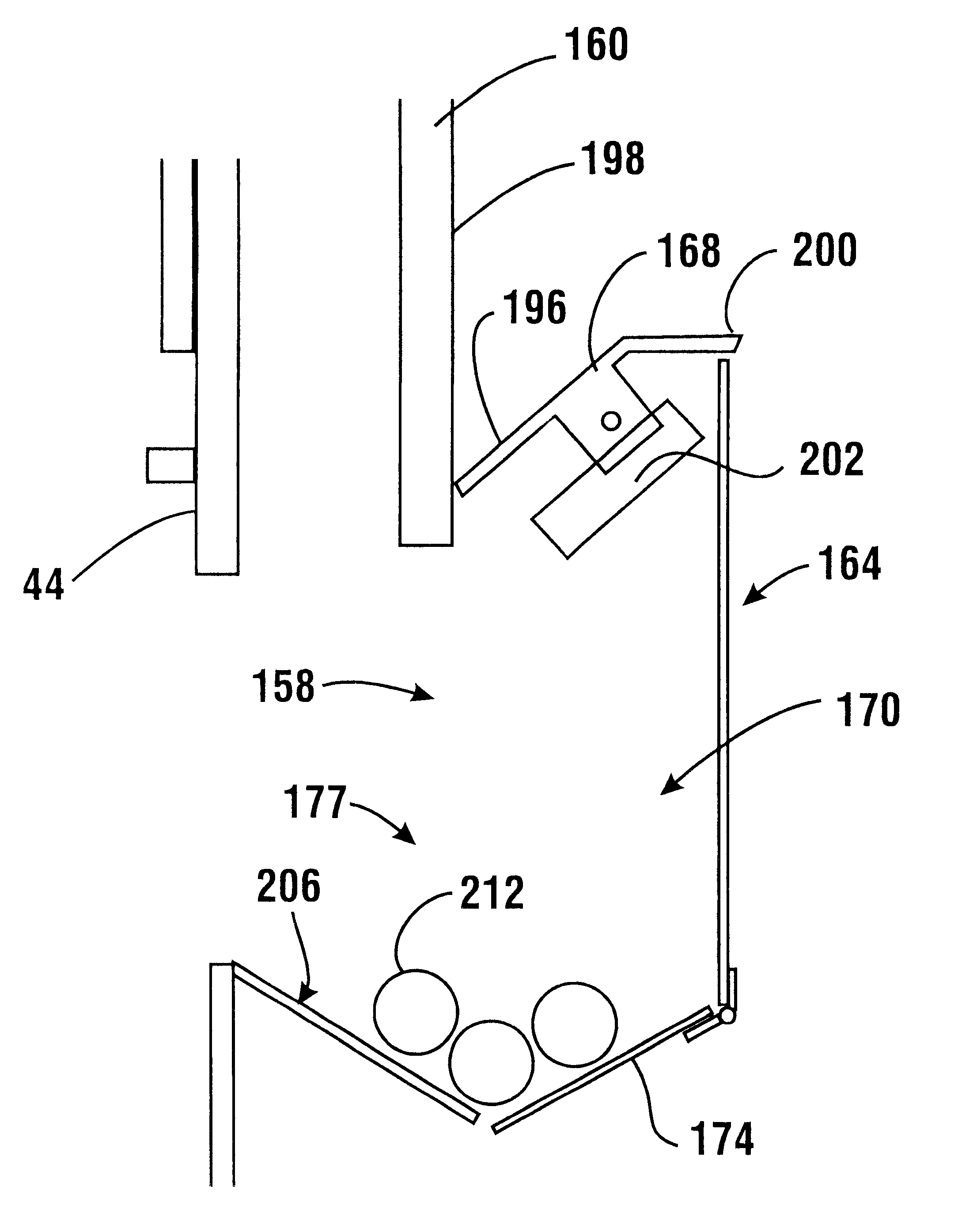

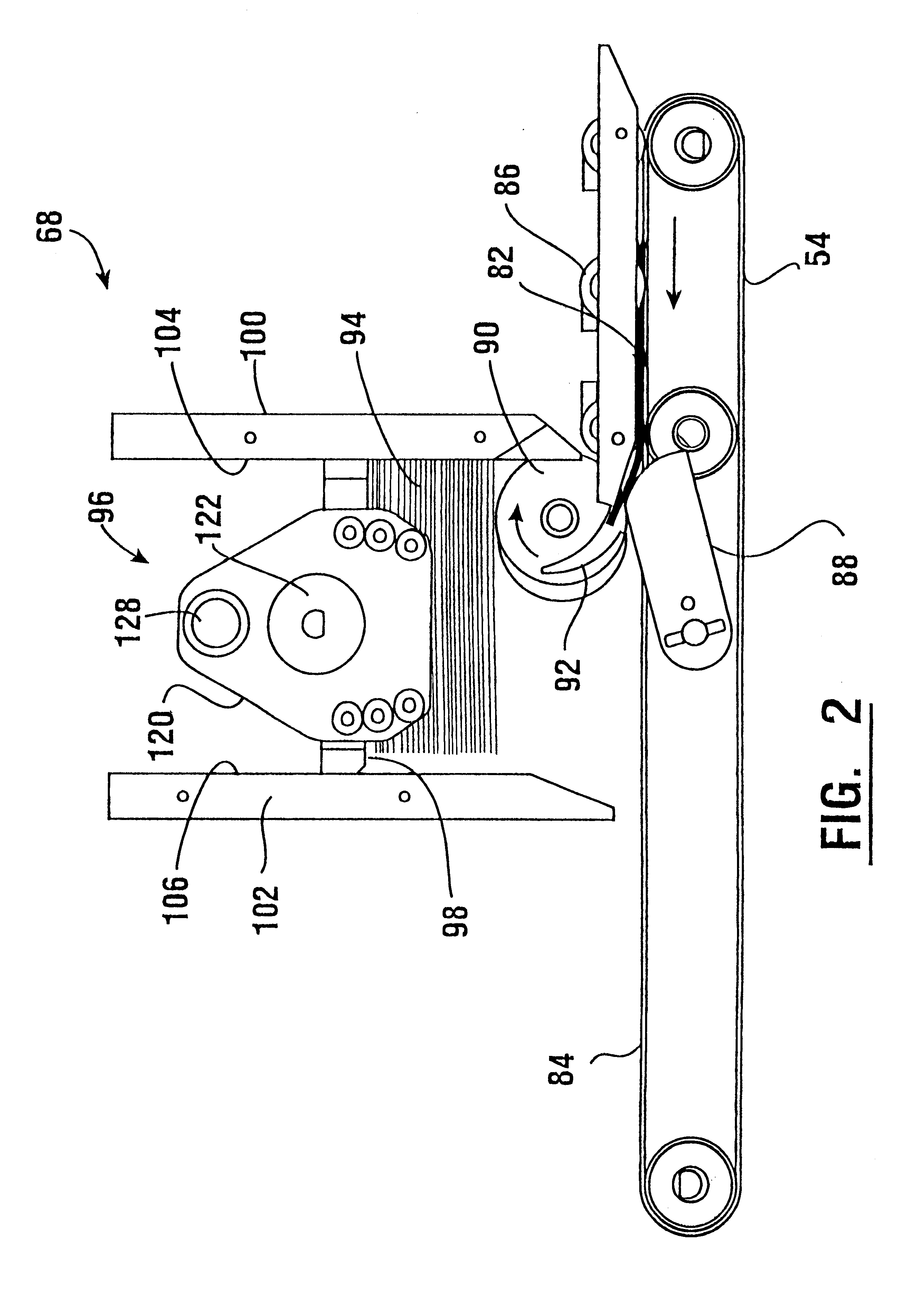

Currency recycling system and method for automated banking machine

InactiveUS6331000B1Stacks sheets reliablyIncrease speedCoin/currency accepting devicesPile receiversMechanical engineeringEngineering

A media storage system for an automated banking machine (10) includes a flipper member (90, 178) which is rotationally movable to engage sheets. A gripper member (138, 182) is movably mounted relative to the flipper member. The flipper member further includes an arcuately extending slot (92, 180). The sheet extending in the slot is held in fixed engagement with the flipper member by the gripper member. Rotation of the flipper member to a releasing position causes the sheet to be engaged with a stop surface (160, 188) as the gripper member moves to release the sheet. Sheets released by the flipper member are positioned in a stack (94, 184). The flexible flap (160) engages each sheet after it has been released by the flipper member to conform the sheet to the stack. In alternative embodiments a flipper member (178) includes a picker portion (202). Picker portion is selectively operated to remove sheets from the stack.

Owner:DIEBOLD NIXDORF

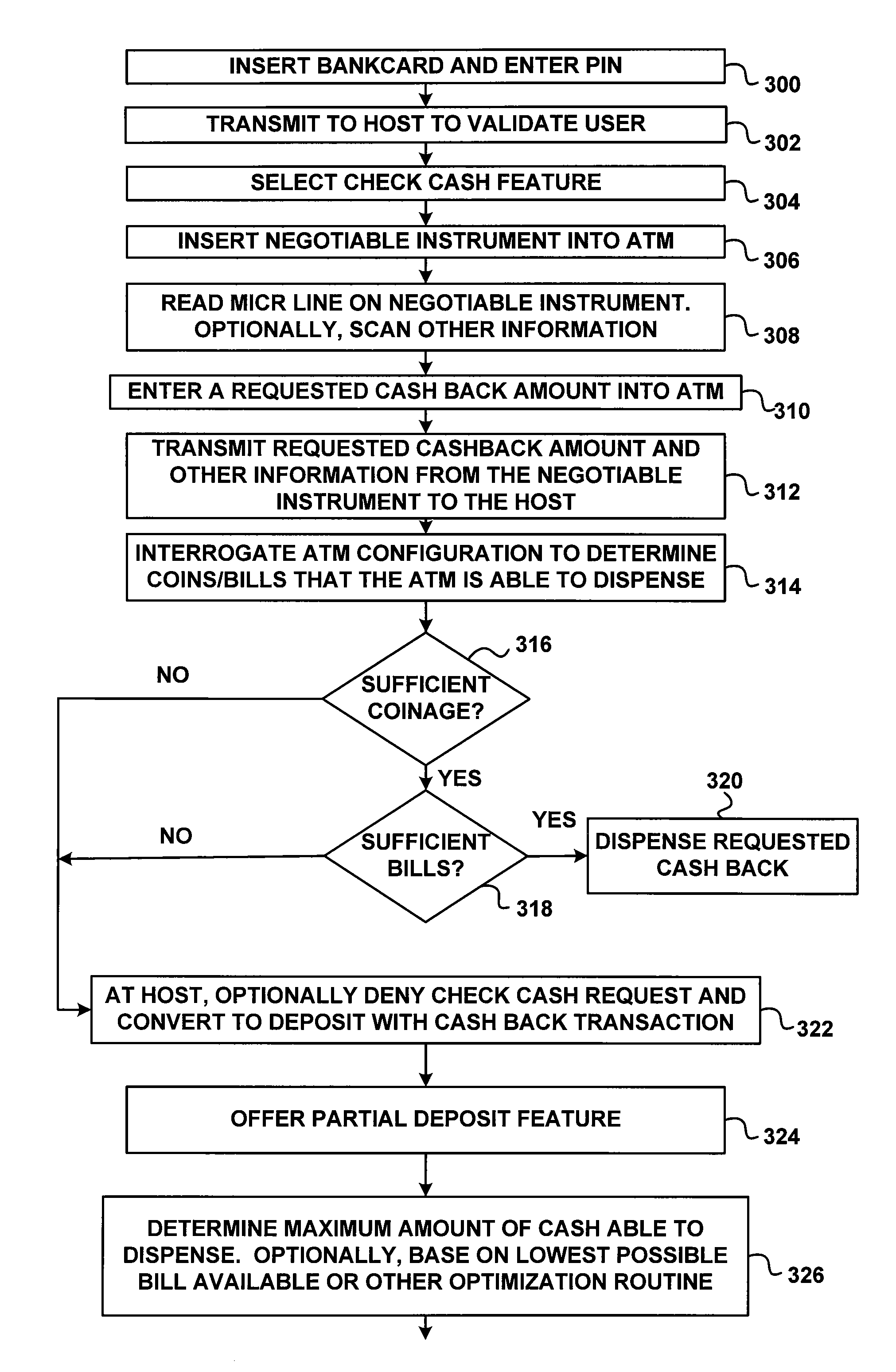

ATM systems and methods for cashing checks

Various techniques are provided for dispensing cash from automated teller or similar cash dispensing machines where such machines do not contain or are otherwise unable to dispense coins or certain bill denominations. Such features may be offered in combination with a request to cash a negotiable instrument, such as a check, where some or all of the amount is to be received in cash or deposited into an account. In one particular method, an automated teller machine (ATM) includes a display screen, a data entry device, a receipt printer, a bill dispenser and a reader. According to the method, information is read from a negotiable instrument using the reader. A face amount of the negotiable instrument is received at the ATM from the data entry device. The display screen is employed to display a dispense amount in bills that the ATM is capable of dispensing along with a deposit account where the remaining funds may be deposited. The user may then enter a confirmation using the data entry device to dispense the bills and to deposit the remaining funds in the deposit account. The bill dispenser may dispense the bills, and an approval may be sent to deposit the funds into the deposit account.

Owner:THE WESTERN UNION CO +1

Check accepting and cash dispensing automated banking machine system and method

InactiveUS7314163B1Minimize the risk of damageReduce the possibilityComplete banking machinesFinanceTransaction dataCheque

An automated banking machine system includes ATMs that can accept checks. Cash may be dispensed from an ATM to the user in exchange for a check. Cancellation indicia can be marked on the check by the ATM. The ATM can acquire image data and magnetic data from a received check to determine the genuineness of the check and the authority of the user to cash the check. A check imaging device of the ATM can generate a digital image of a received check. The check image data can be stored in correlated relation with the related transaction data. The ATM can also modify the check image data to produce a modified check image that excludes sensitive check information, such as the user's account number in the micr line. The ATM can then print this modified check image on the user's transaction receipt.

Owner:DIEBOLD NIXDORF

Deposit accepting and storage apparatus and method for automated banking machine

InactiveUS6474548B1Minimize the risk of damageReduce the possibilityComplete banking machinesRegistering devicesEngineeringInstrumentation

An automated banking machine (10) includes a deposit accepting apparatus (44) which is capable of accepting and authenticating instruments, as well as accepting envelopes deposited into the machine by a user. A transport section (46) is operative to engage and transport deposited items selectively from an inlet (48) to an outlet (50). A deposit holding module (90) includes compartments (98, 106) which are operative to hold different types of deposits. The machine operates to selectively move a compartment into communication with the outlet based on the particular type of item being deposited. The depository apparatus is further operative to acquire image and magnetic profile data from deposited instruments, to manipulate the image and profile data and to analyze and resolve characters in selected areas thereof. The data from deposited instruments is used for determining if a user is authorized to conduct certain requested transactions at the machine.

Owner:DIEBOLD NIXDORF

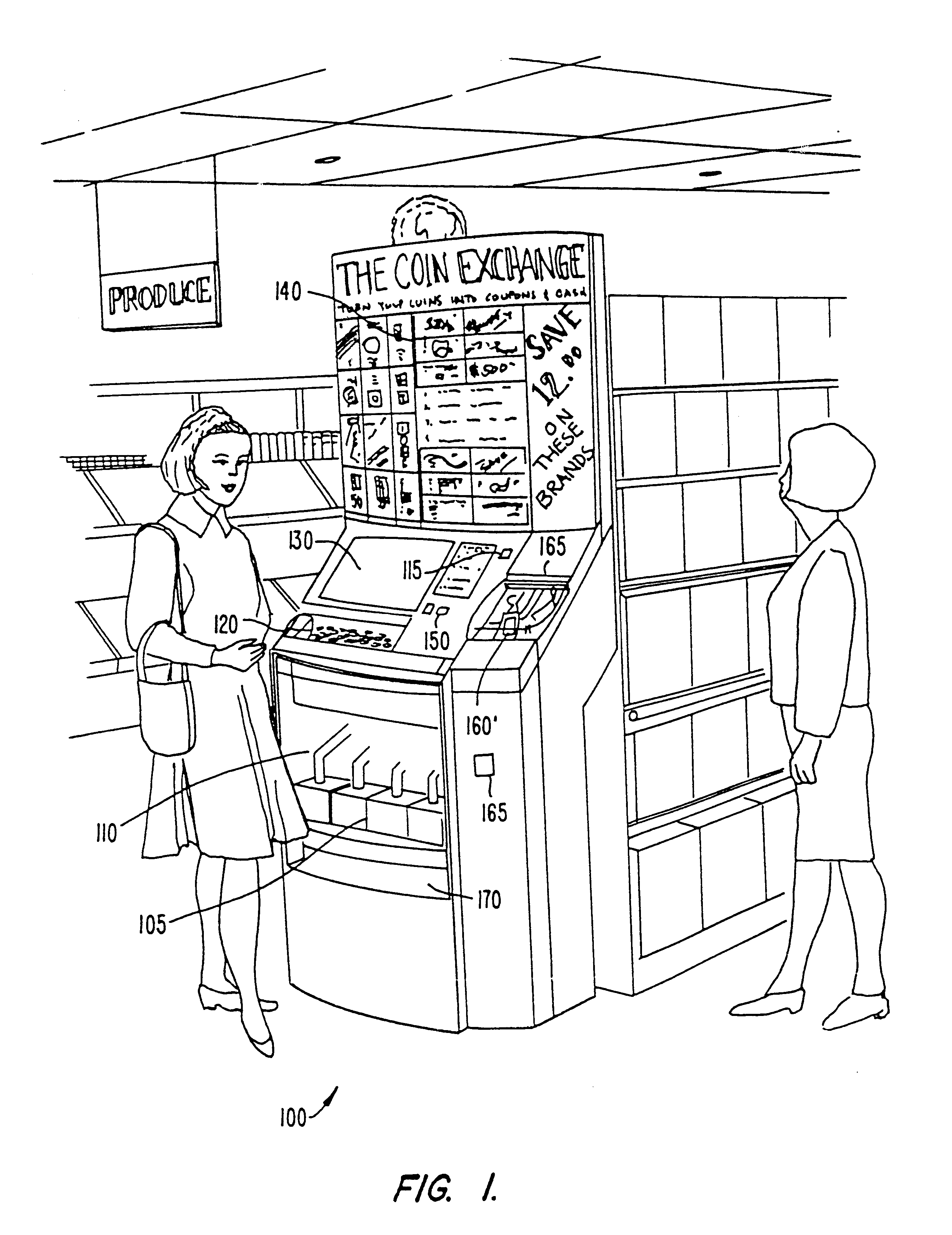

Coin counter and voucher dispensing machine and method

InactiveUS6854581B2Easy maintenanceIncrease goodwillControlling coin-freed apparatusDigital data processing detailsEngineeringVoucher

A coin sorting and counting machine and a method for operating it to automatically dispense cash vouchers based on the value of the counted coins, manufacturers' coupons and store coupons. Coins are placed in a hopper tray angled downward from the horizontal. When the hinged tray is lifted, the coins travel over a peak structure, through a waste management system and into the coin sorting and counting apparatus. The value of the coins and the number of coins within each denomination are displayed as the coins are counted. The coins fall into a storage area and the user is issued a cash voucher and a series of manufacturer coupons.

Owner:COINSTAR LLC

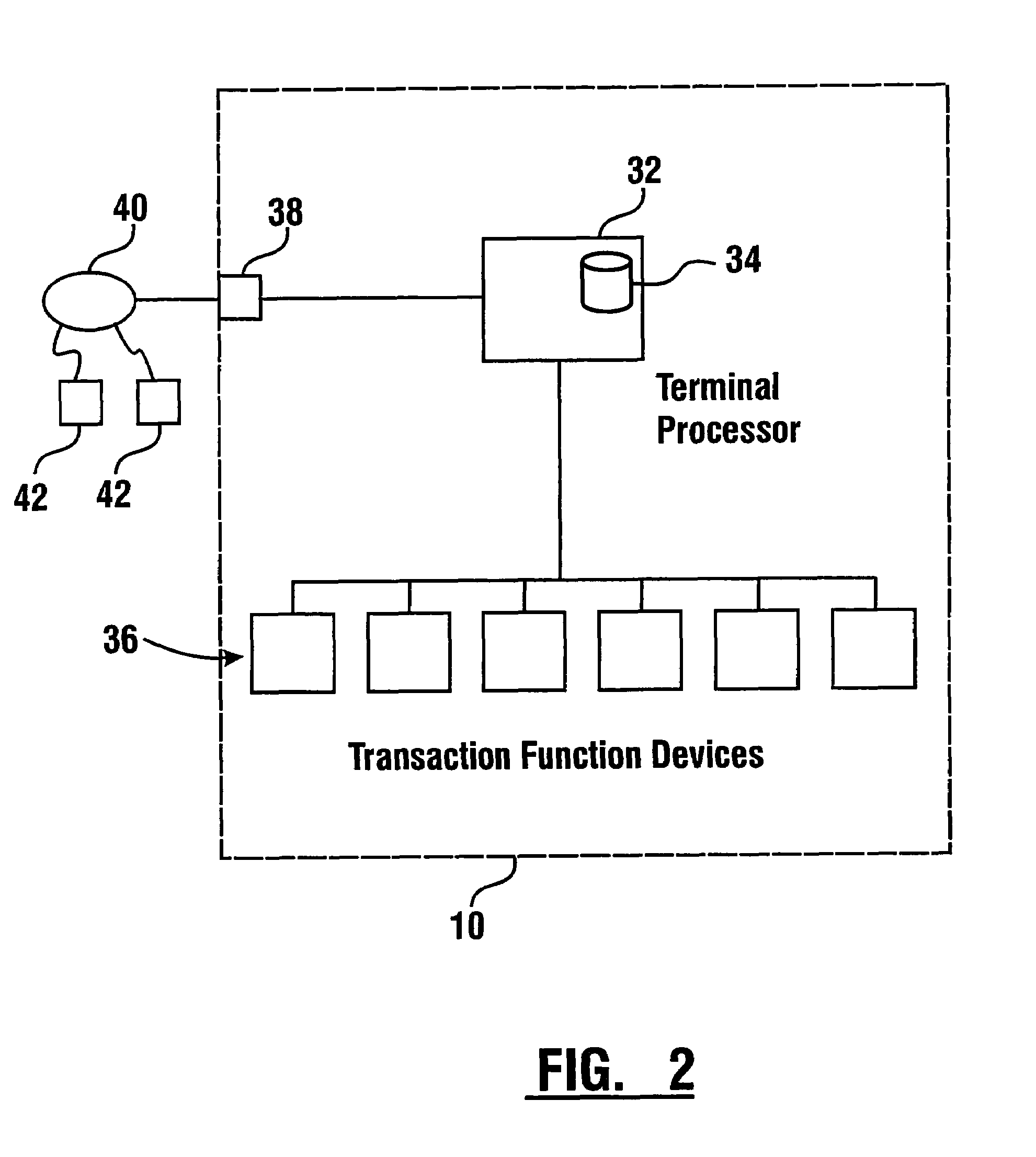

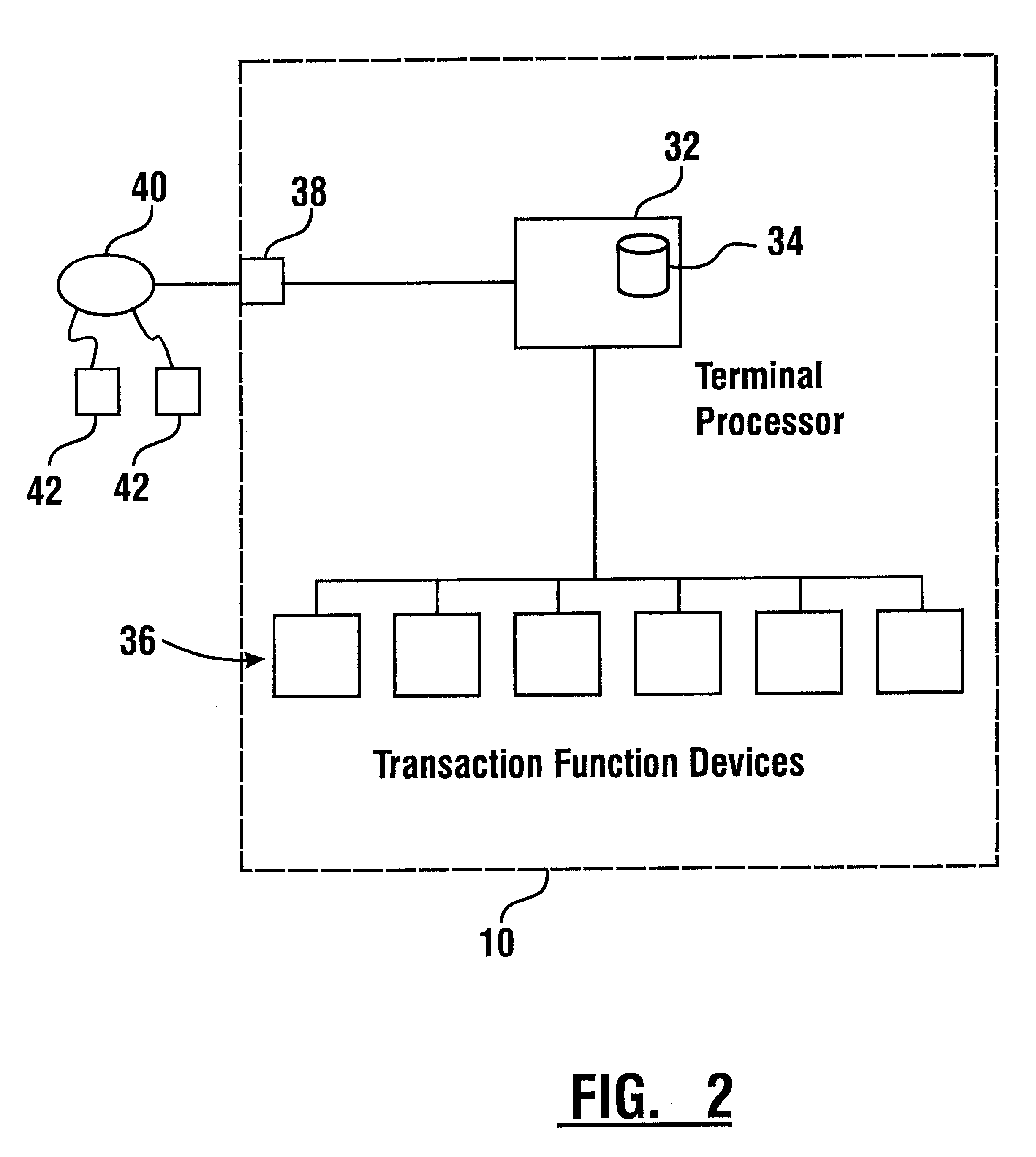

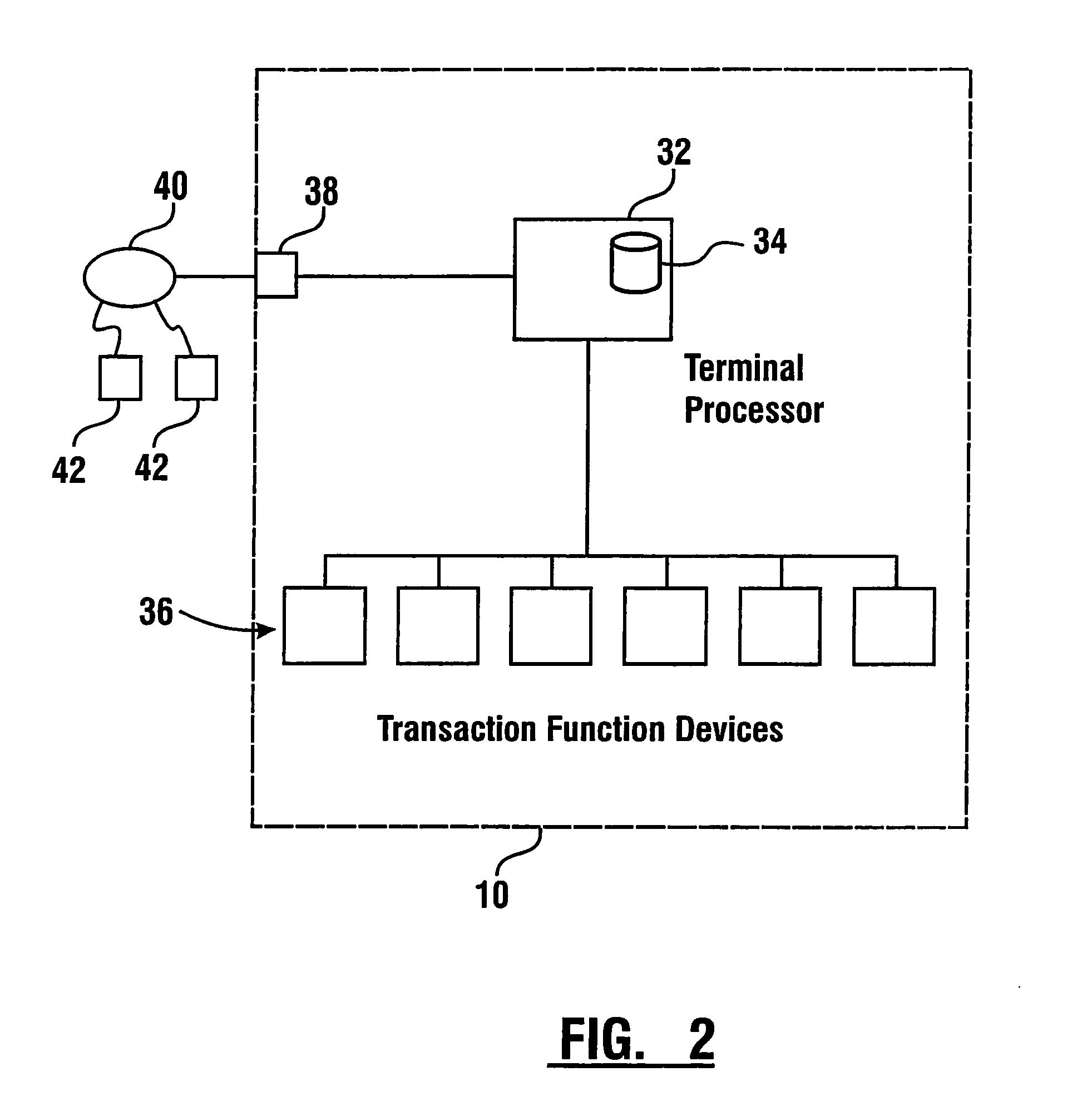

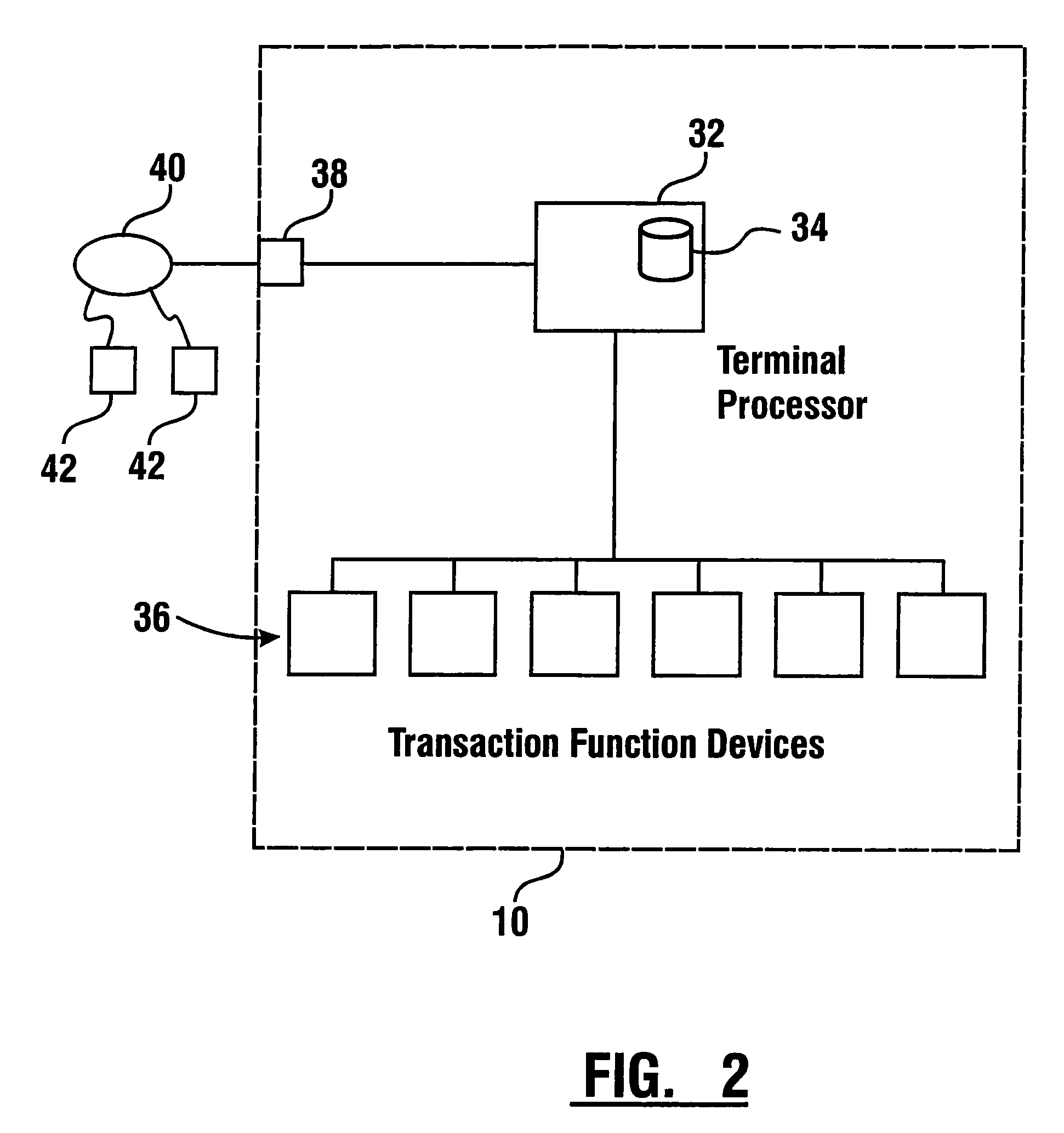

Control system communication apparatus and method for currency recycling automated banking machine

InactiveUS6131809AEasy to operateEasy to handleComplete banking machinesFinanceMachine selectionControl system

An automated banking machine (10) identifies and stores documents such as currency bills deposited by a user. The machine then selectively recovers documents from storage and dispenses them to other users. The machine includes a central transport (70) wherein documents deposited in a stack are unstacked, oriented and identified. Such documents are then routed to storage areas in recycling canisters (92, 94, 96, 98). When a user subsequently requests a dispense, documents stored in the storage areas are selectively picked therefrom and delivered to the user through an input / output area (50) of the machine. The control system (30) for the machine includes a terminal processor (548). The terminal processor communicates with a module processor (552). The module processor (552) communicates with module controllers (554, 556, 558, 560, 562 and 564) which control the operation of devices. The module processor coordinates the activities of the module controllers to achieve the processing of documents reliably and at high speeds. A special protocol is used to communicate messages between the module processors and module controllers which provides increased reliability.

Owner:DIEBOLD NIXDORF

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com