Patents

Literature

79 results about "Magnetic ink character recognition" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

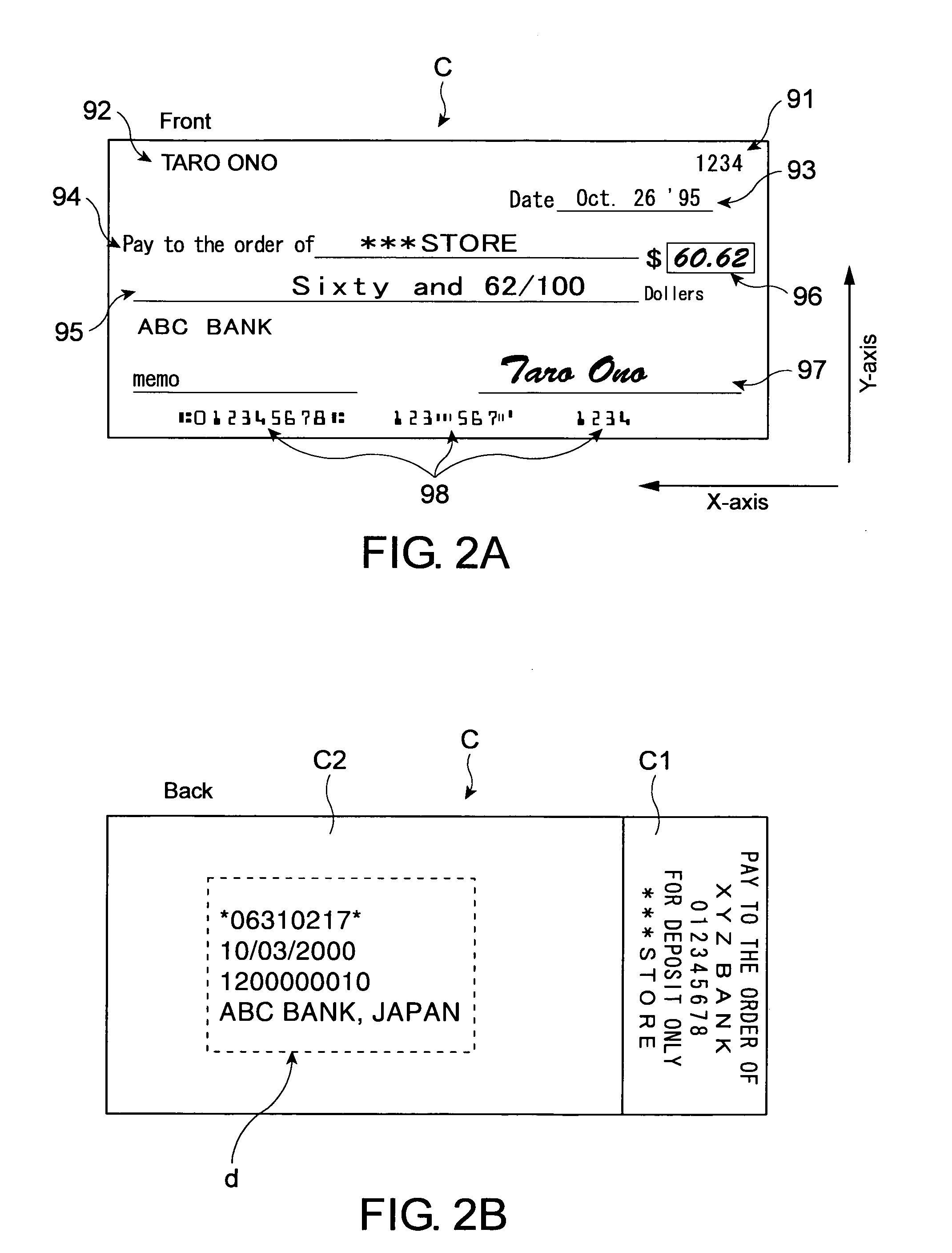

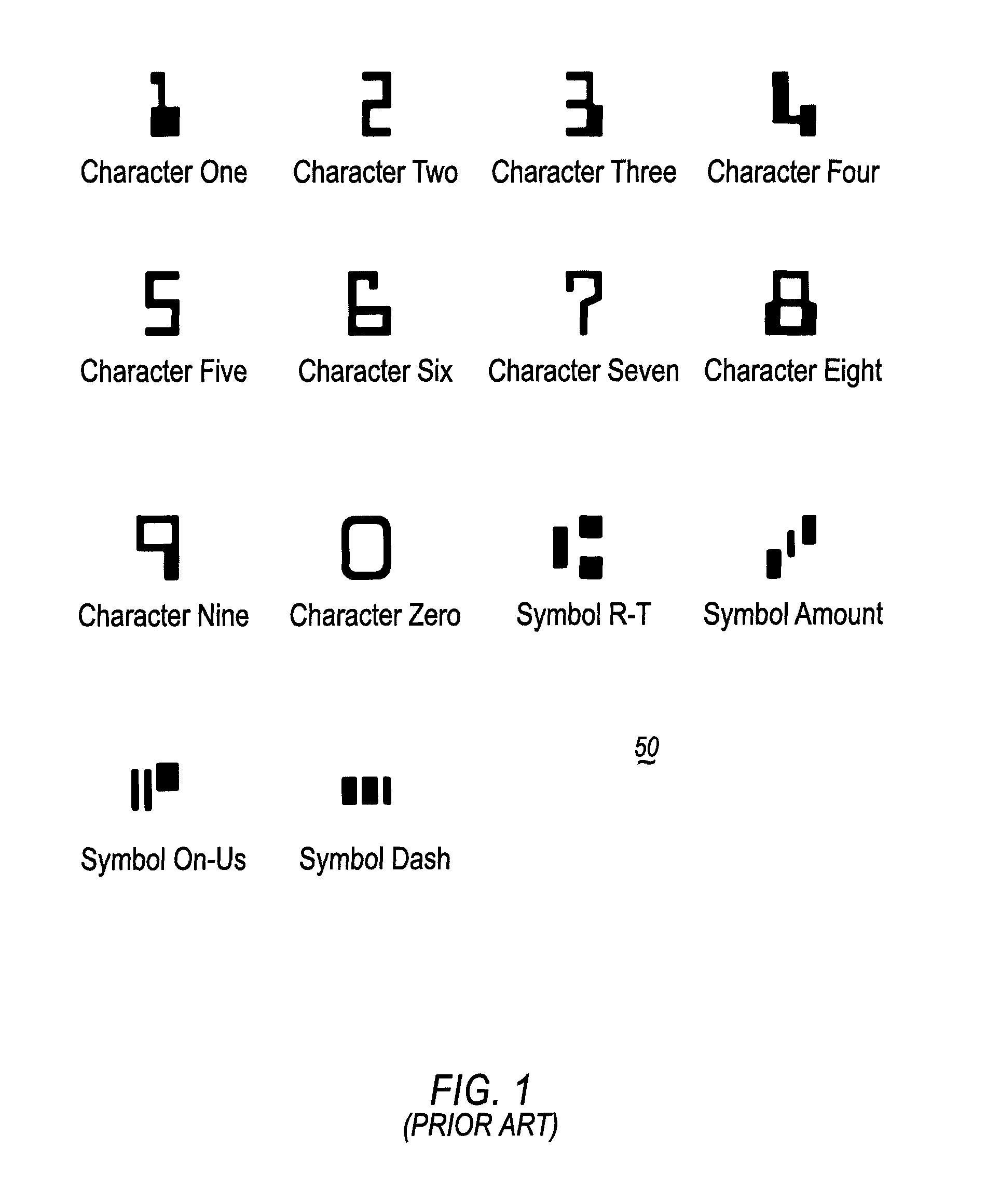

Magnetic ink character recognition code, known in short as MICR code, is a character recognition technology used mainly by the banking industry to streamline the processing and clearance of cheques and other documents. MICR encoding, called the MICR line, is at the bottom of cheques and other vouchers and typically includes the document-type indicator, bank code, bank account number, cheque number, cheque amount (usually added after a cheque is presented for payment), and a control indicator. The format for the bank code and bank account number is country-specific.

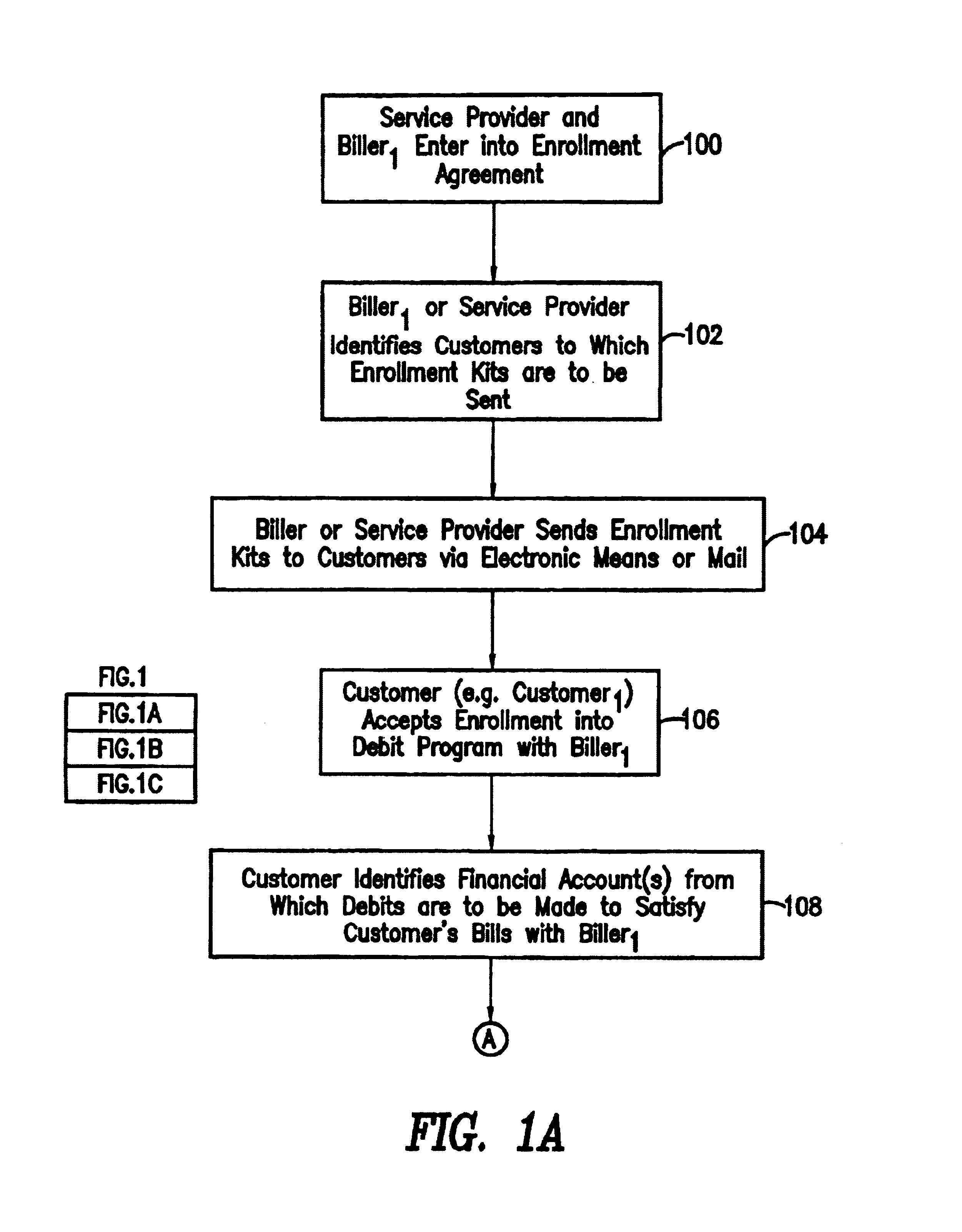

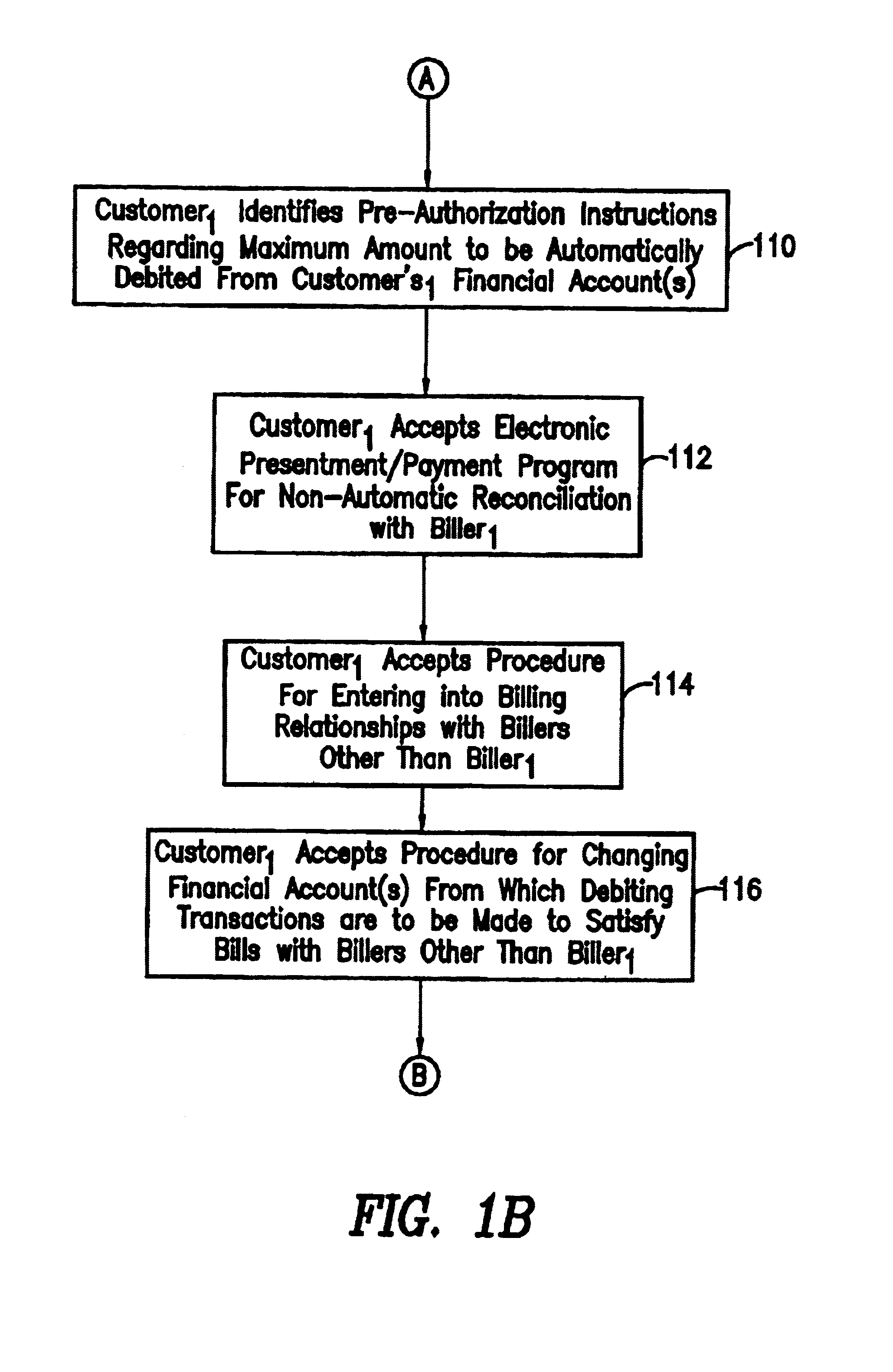

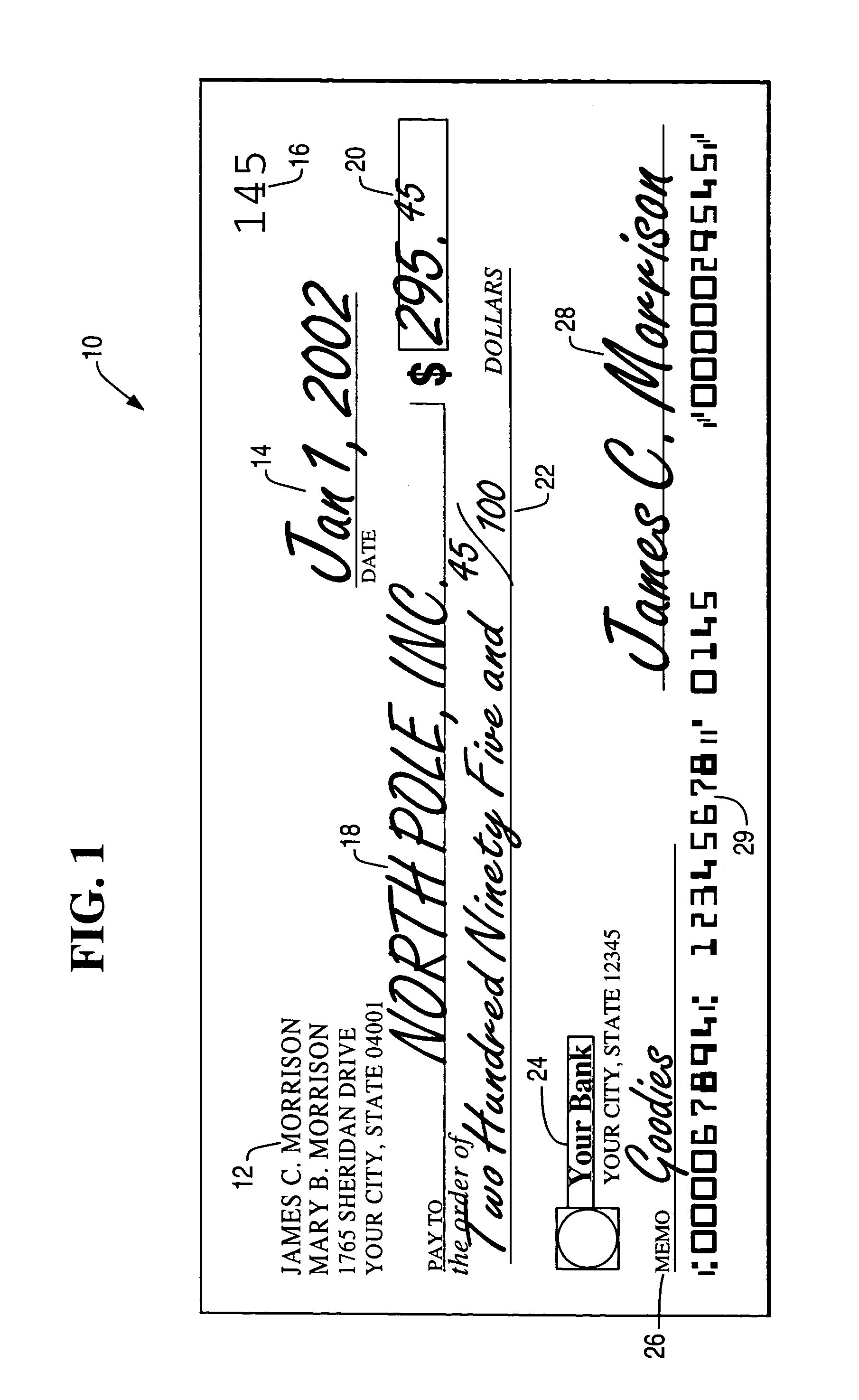

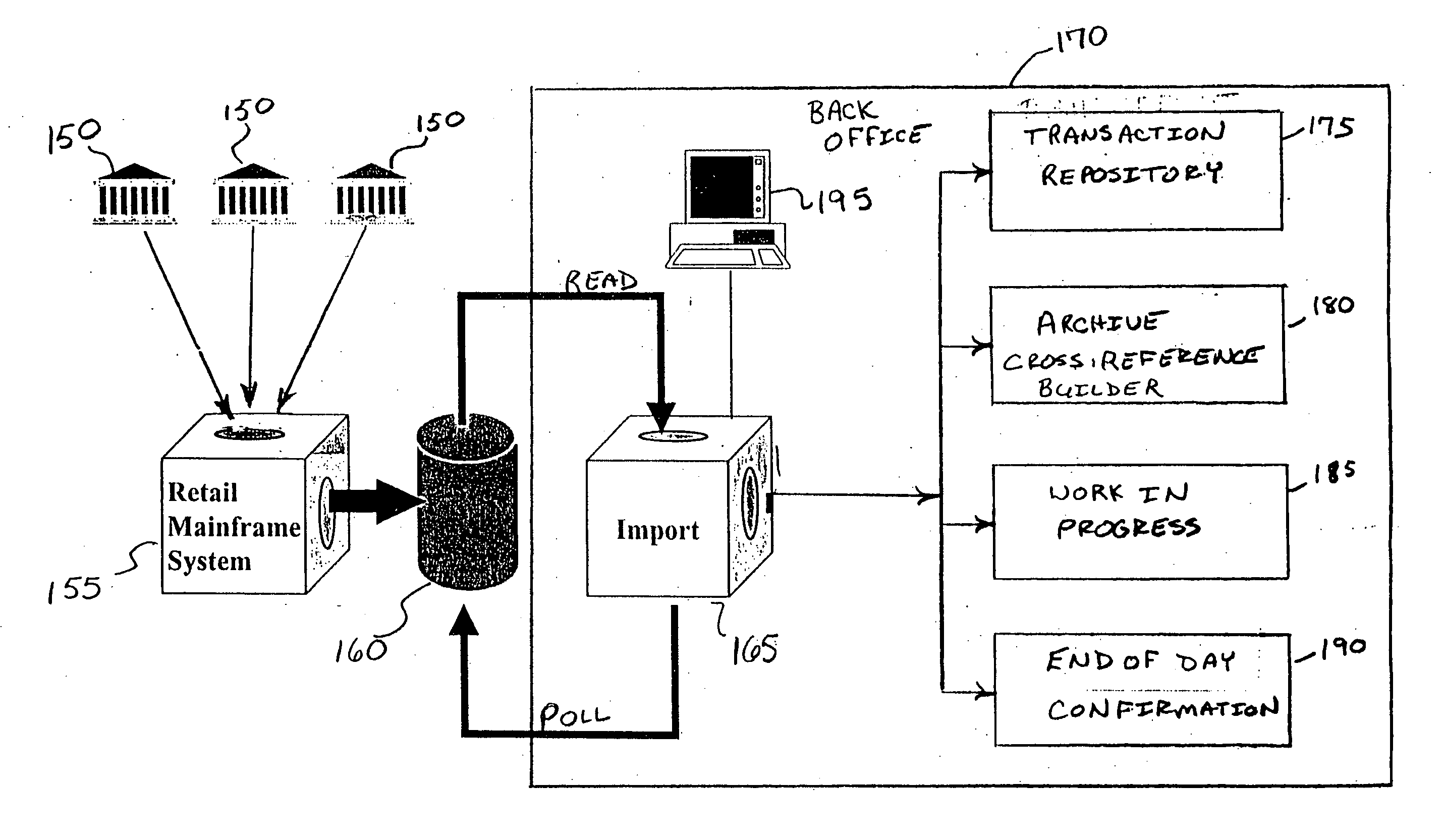

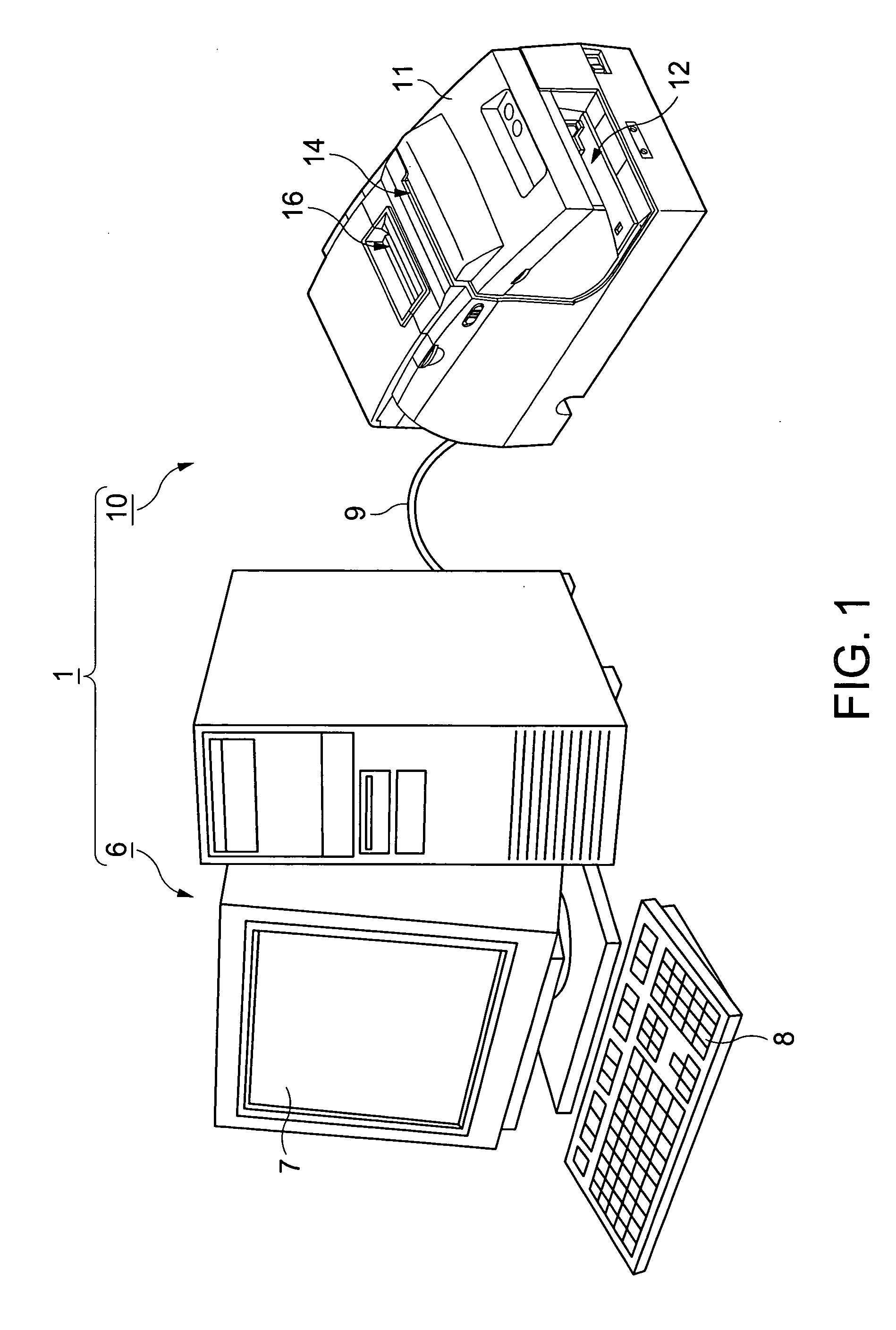

System and method for back office processing of banking transactions using electronic files

InactiveUS7062456B1Reduce equipmentReduce laborFinanceAutomatic teller machinesBank tellerRelevant information

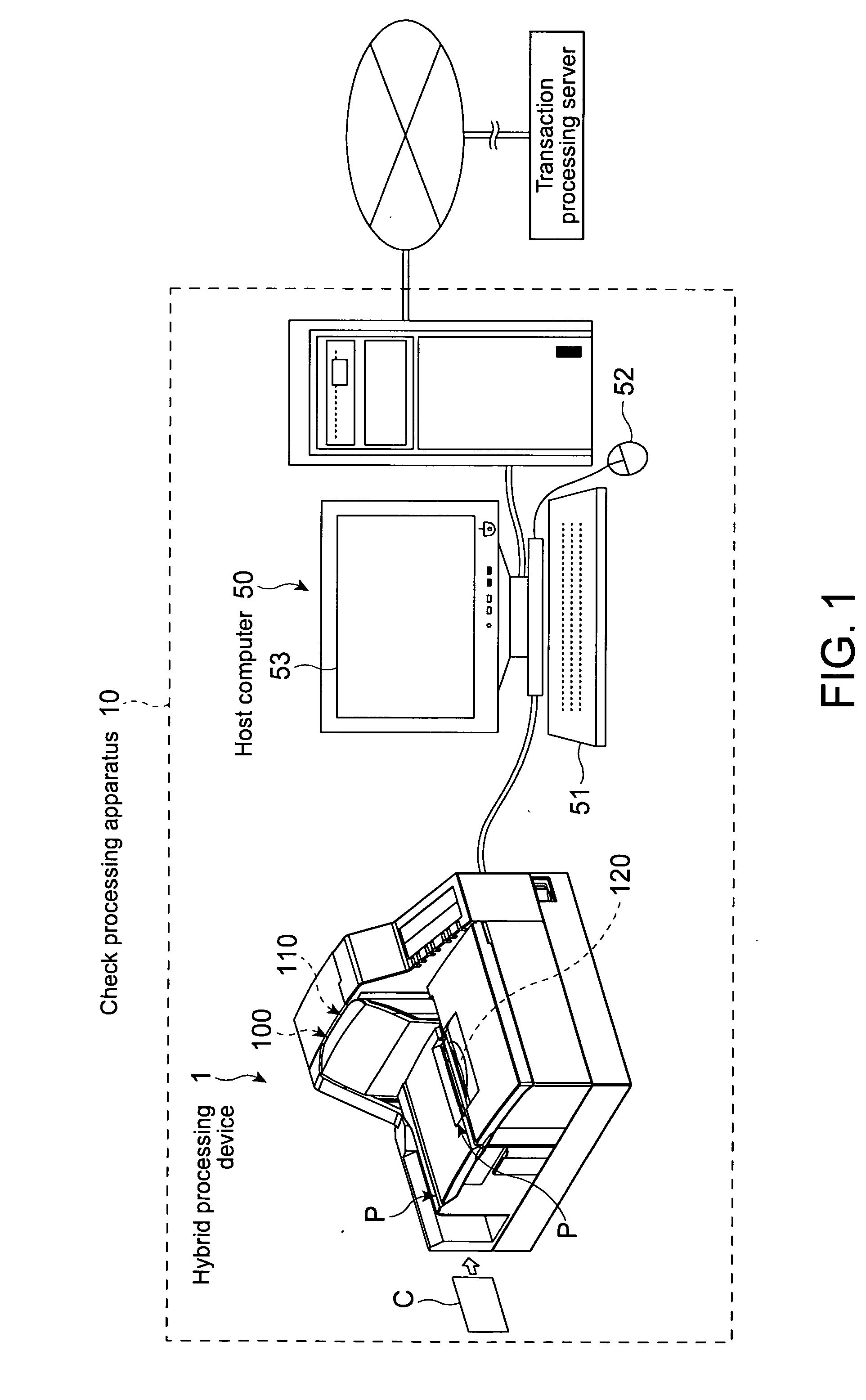

As banking transactions are processed by a bank teller, all of the relevant information with respect to the transaction (e.g., dollar amount) is captured in an electronic file. Each of the electronic files from the various branches of the bank are forwarded to a central back office processing center where the electronic files are combined into a single Transaction Repository. At the end of the branch day, all of the paper associated with the transactions is forwarded from the branches to the back office processing center. The paper transactions are imaged in the conventional manner and the Magnetic Ink Character Recognition (MICR) data is read from the paper. The present invention then automatically correlates the images and MICR data captured from the paper with the complete transaction record contained in the Transaction Repository. Most of the conventional back office processing can now be performed without the need to perform character recognition and without the need for excess human intervention.

Owner:JPMORGAN CHASE BANK NA

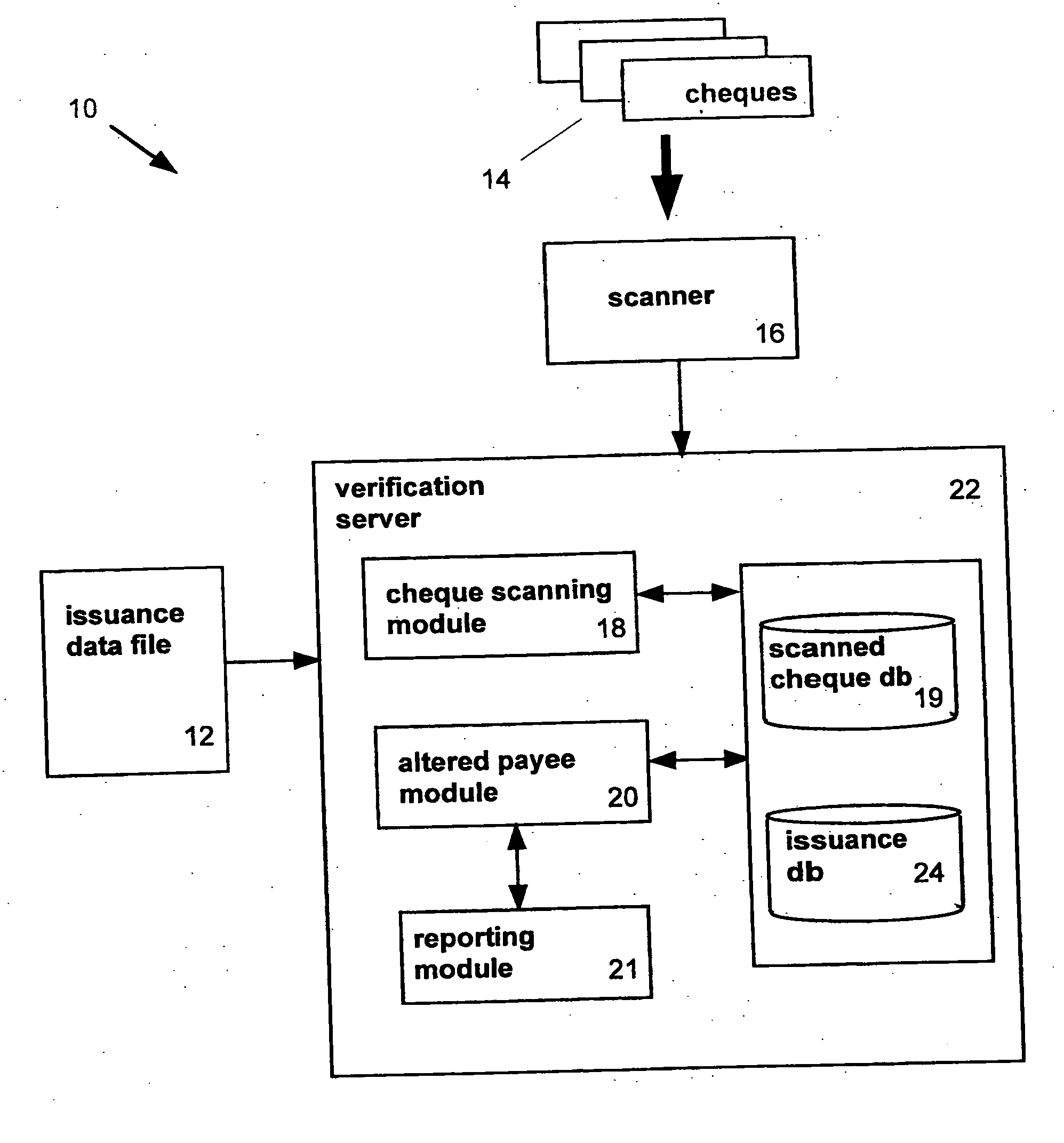

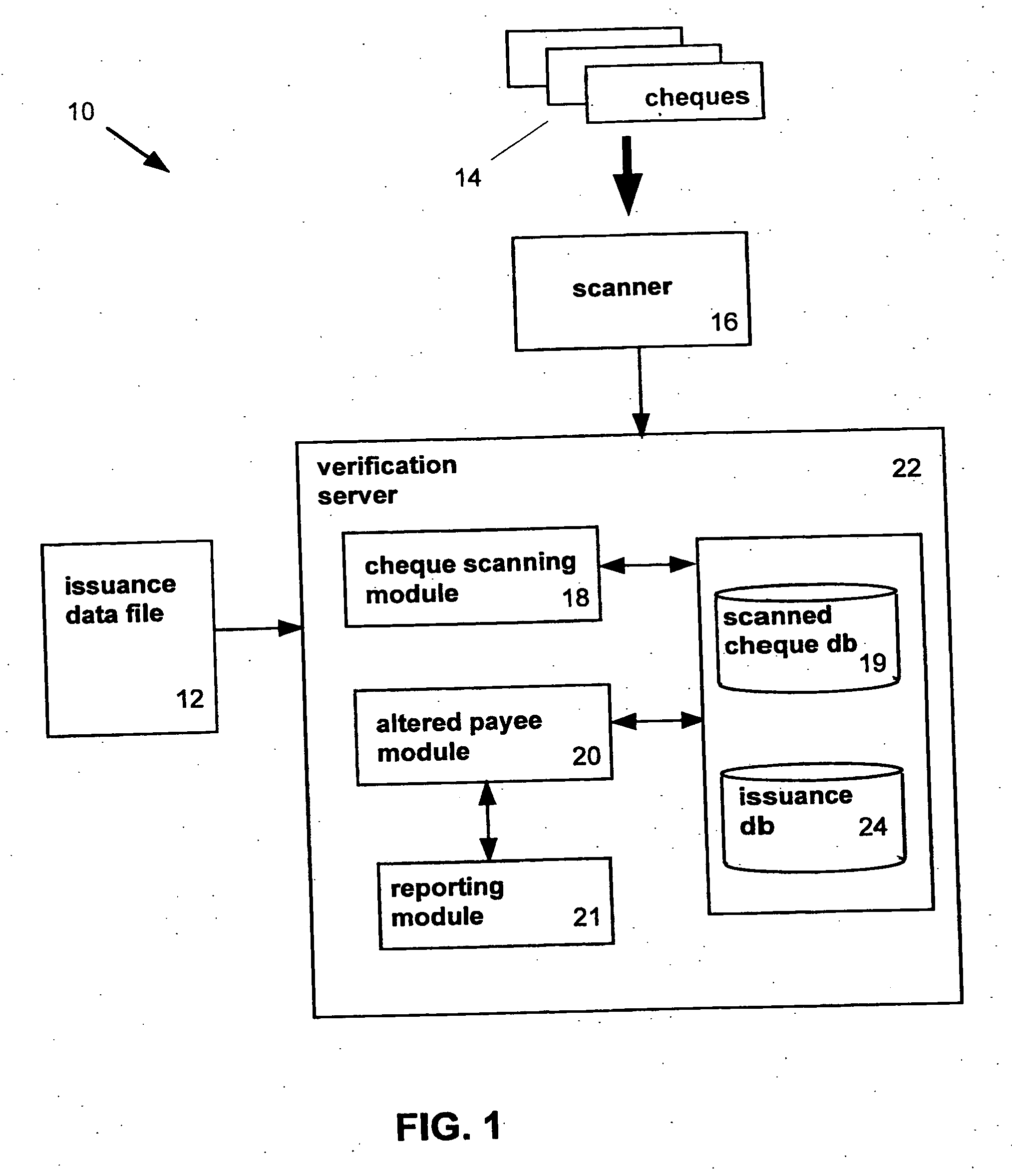

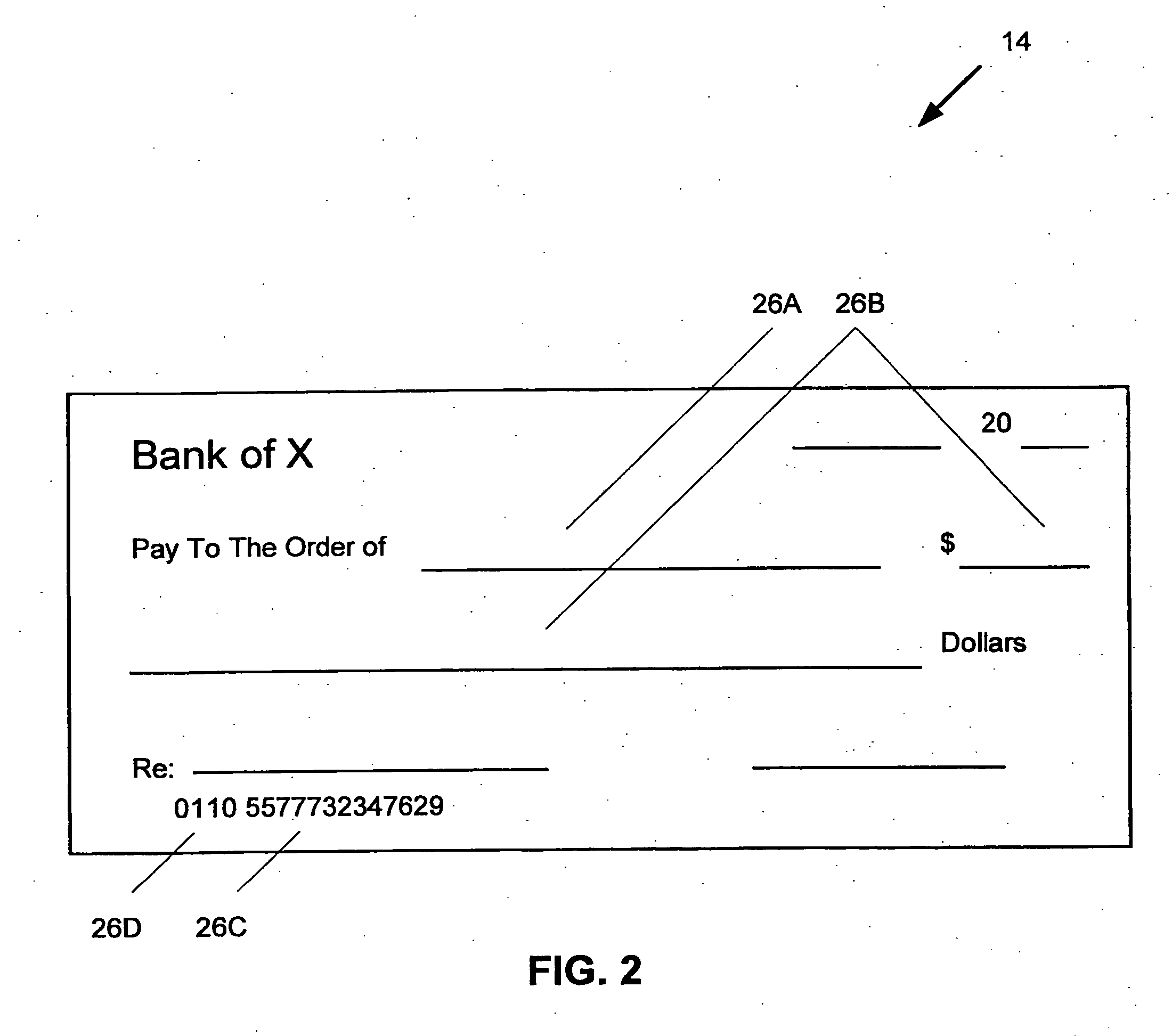

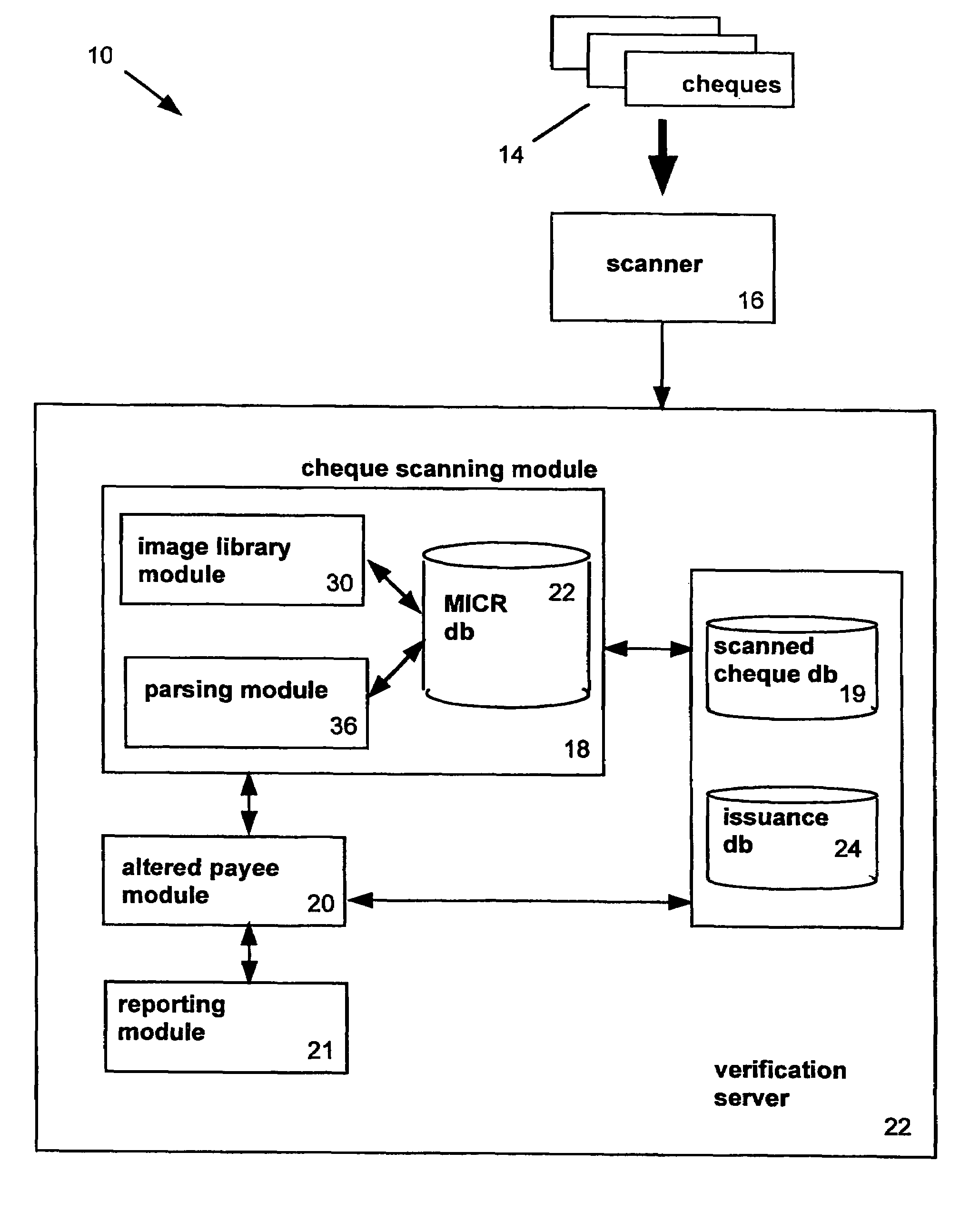

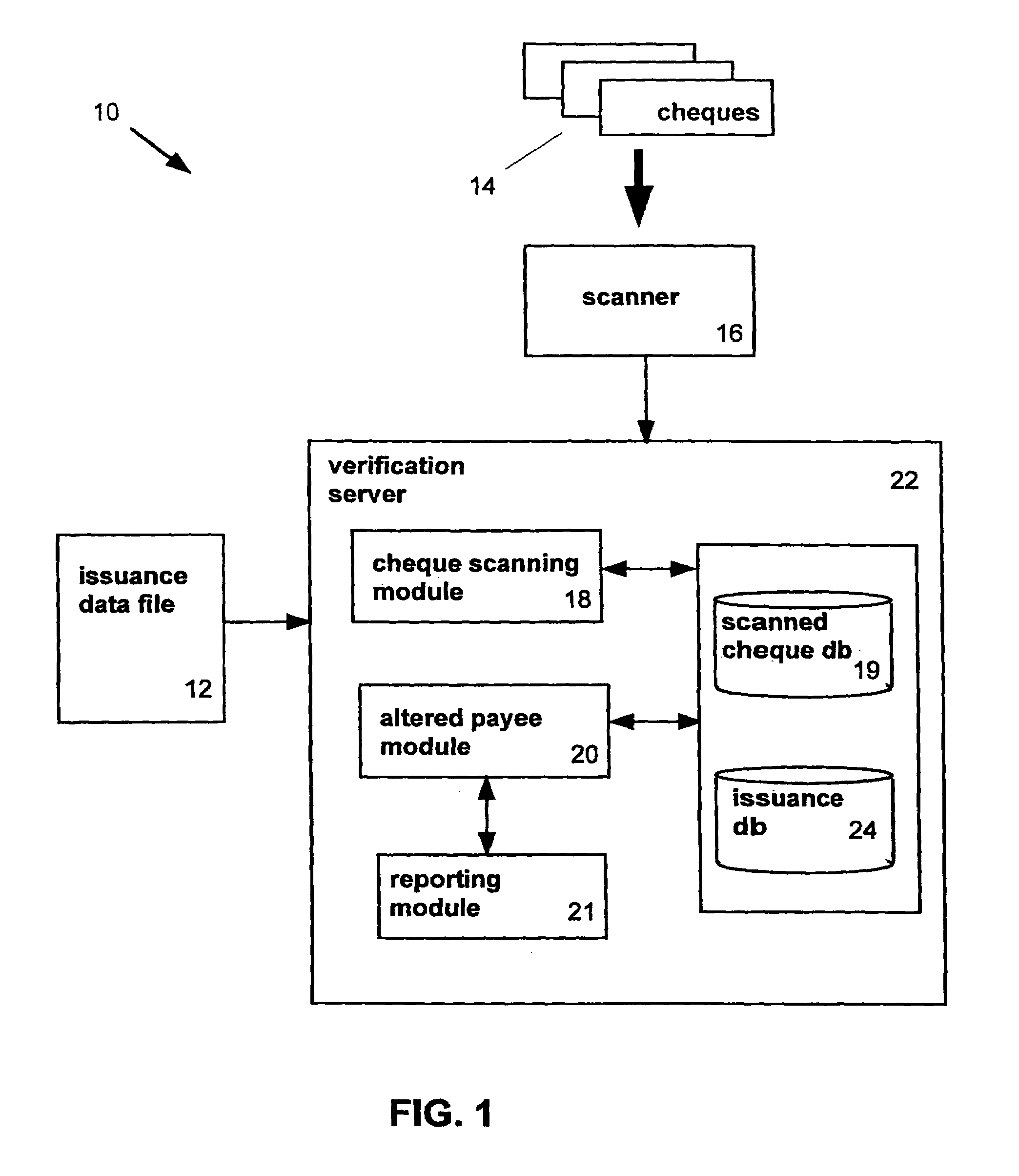

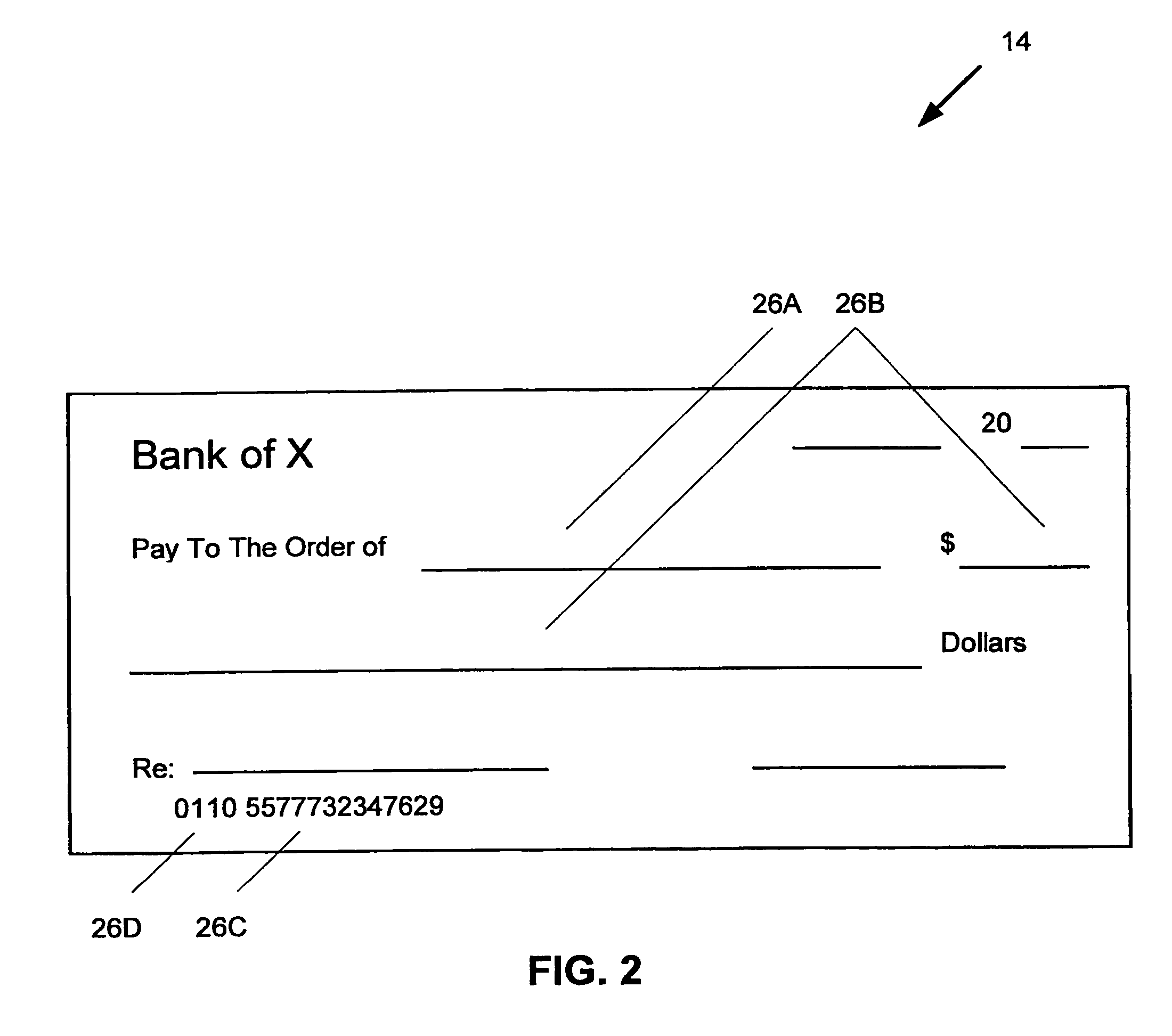

System and method for detecting cheque fraud

A system and method for detecting cheque fraud includes a cheque scanning module and a detection module. The cheque scanning module scans cheques and matches the encoded Magnetic Ink Character Recognition (MICR) data (i.e. serial number, Customer Account Number and amount) from the scanned digital electronic images with items in an issuance database which contains client provided cheque particulars. The detection module passes the cheque images through an optical character recognition (OCR) process to read what is written on the cheque and to match results against the issuance database. If the written information on the face of a cheque is unreadable or there is no match with the information in the issuance database, the detection module passes the cheque through a series of slower more precise OCR processes. Any cheques that are not successfully read and matched are highlighted as an “exception” and immediately forwarded to the client for further action.

Owner:ELECTRONICS IMAGING SYST CORP

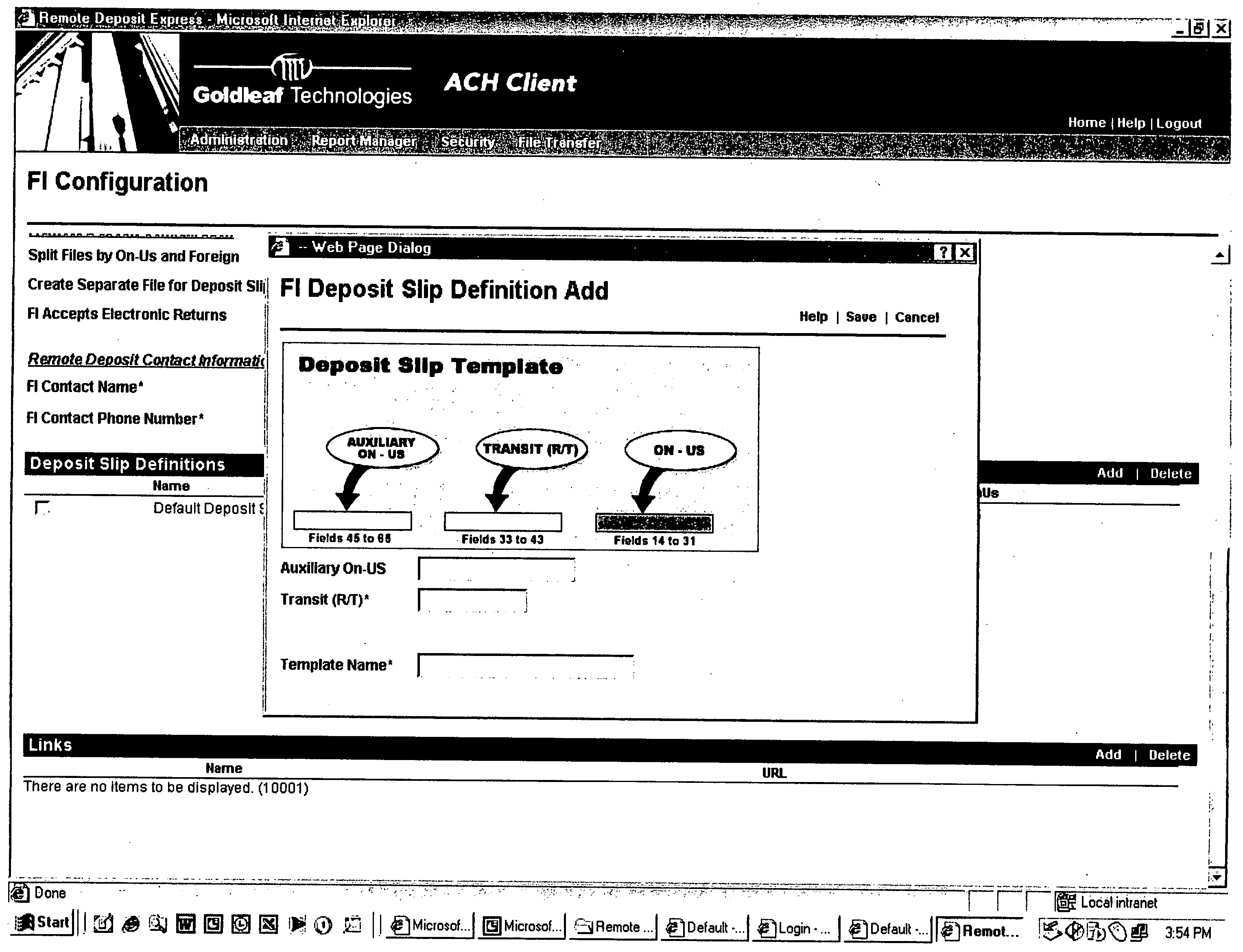

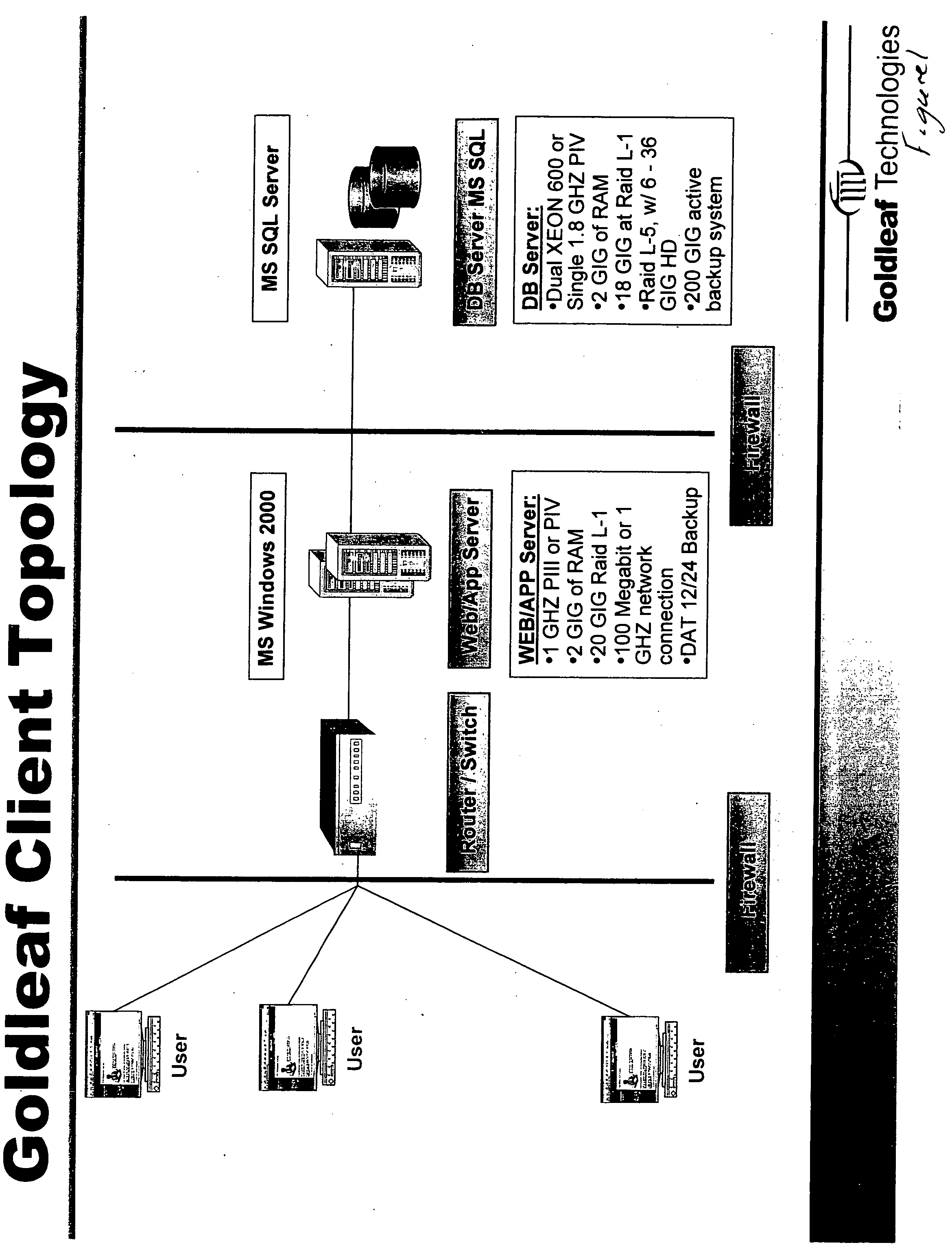

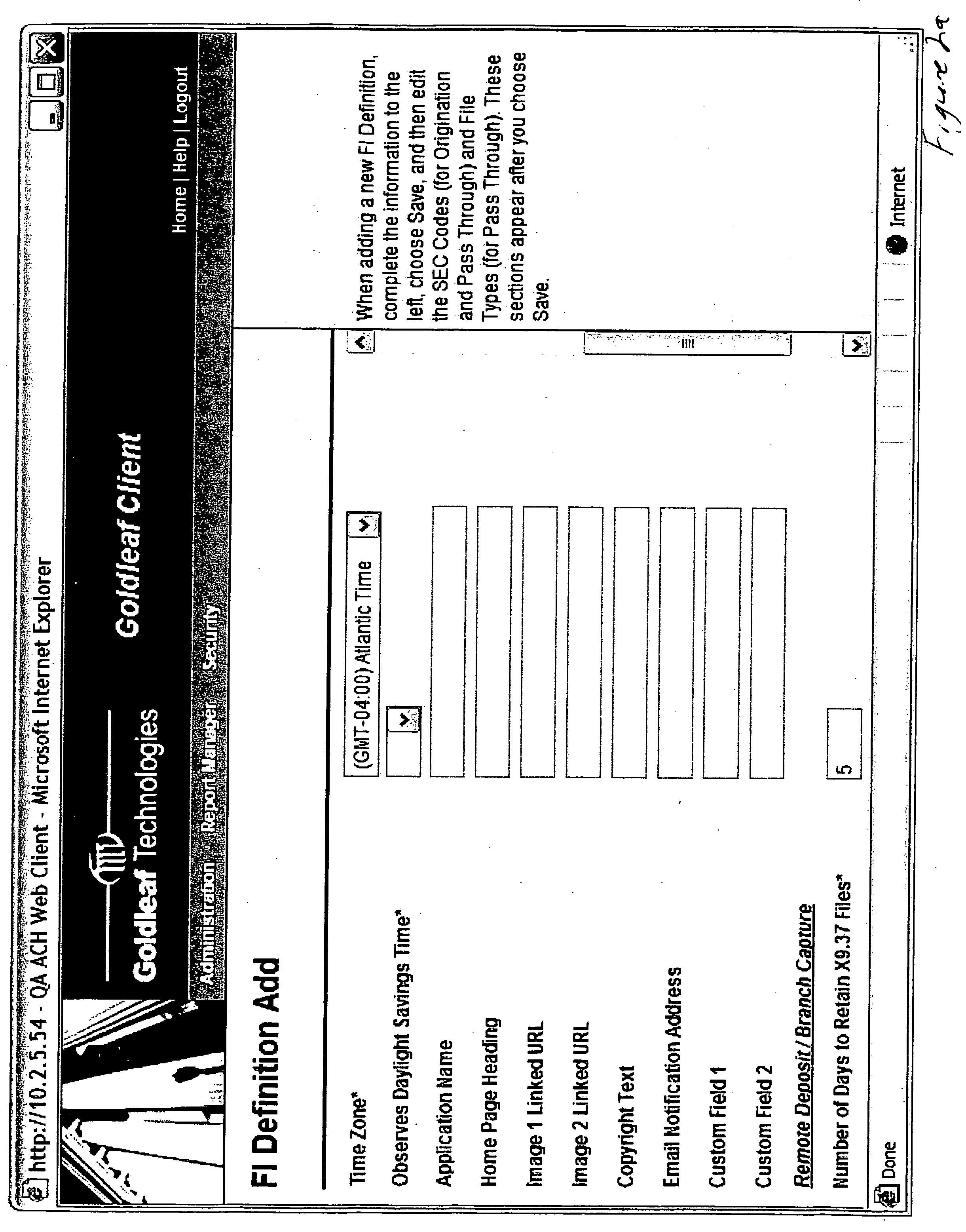

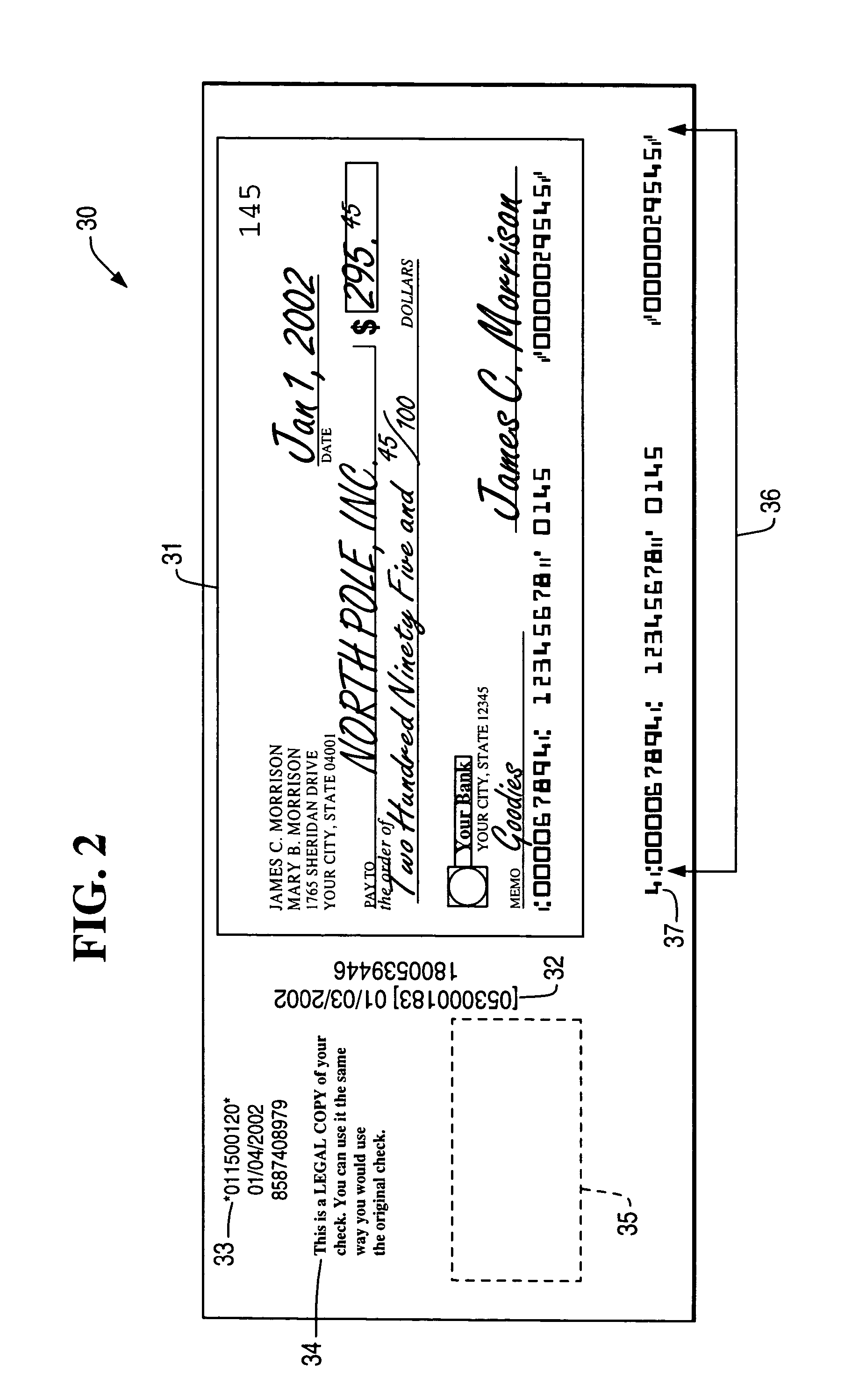

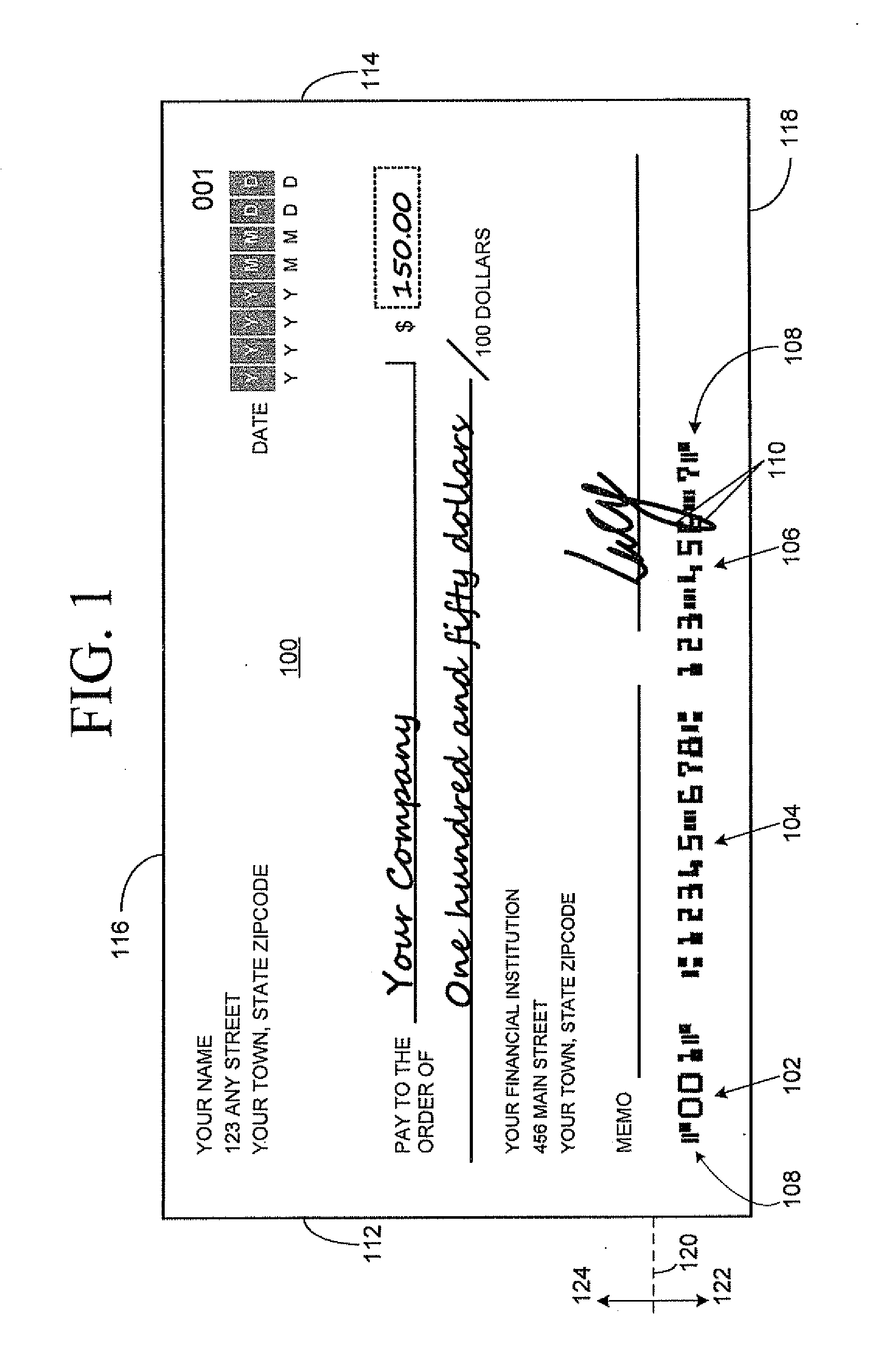

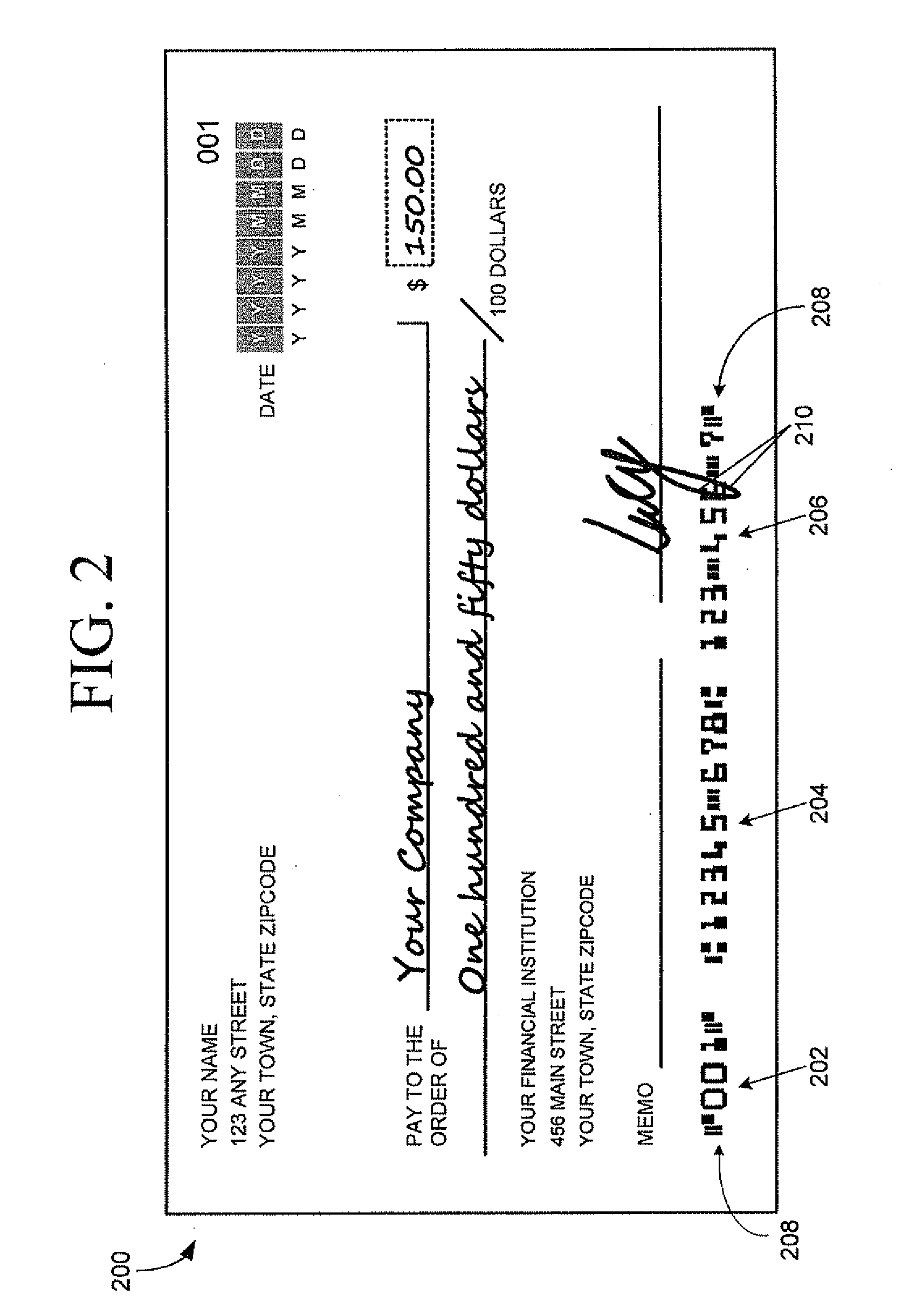

Remote check deposit

InactiveUS20060242062A1Easy to optimizeConvenient truncationFinancePayment circuitsDocumentation procedureSubstitute check

In accordance with the principles of the present invention, a system is provided for capturing a customer deposit at their place of business, converting the Magnetic Ink Character Recognition (MICR) data encoded documents into an image with an associated data file, and electronically transmit the data to a financial institution. The system allows the customer to scan each MICR encoded check that is to deposited with their financial institution, which captures financial institution routing information and customer account information. The associated image the physical check can be franked denoting the check has been electronically processed to avoid further processing. The resulting image and account data can then be processed by the financial institution. There are three options for encoding the amount: 1) the customer enters each amount after scanning the item prior to sending to the financial institution; 2) the financial institution enters the amount of each item after receiving the file from the customer; and 3) the amount field(s) are scanned and the amount is automatically entered. The system allows for both 1) online (Internet) capture of the MICR data and the associated image or 2) offline capture and the subsequent importing of the image and MICR data for transmission to the financial institution via the Internet. The financial institution can review the items captured online, and repair any item that is incorrect. The financial institution can use the system to print substitute checks that confirm to ANSI X9.90 for processing or deliver an electronic file in ANSI X9.37 format to any check processing system. The system includes secure transport over Internet connections for file transfer and dual control security to reduce fraudulent transactions from being initiated by the customer.

Owner:GOLDLEAF TECH

Methods for transaction processing

A method for transaction processing is presented. In particular, the present invention discloses a method for transaction processing which includes receiving a third party transaction, receiving financial information of the third party transaction where the financial transaction further includes a Magnetic Ink Character Recognition (MICR) data and a representation of the third party transaction; and settling the third party transaction.

Owner:EASYCHECK

Remote negotiable instrument processor

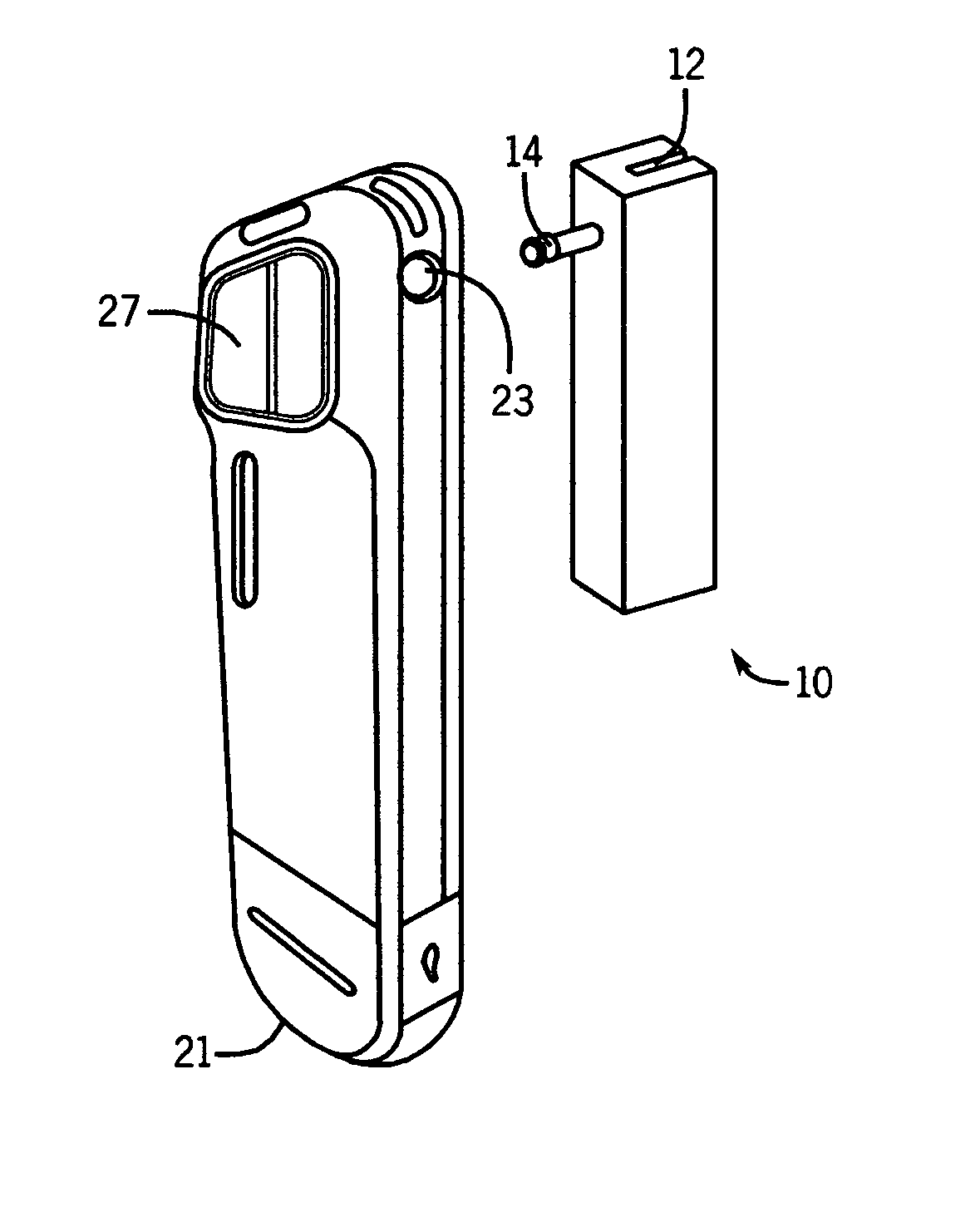

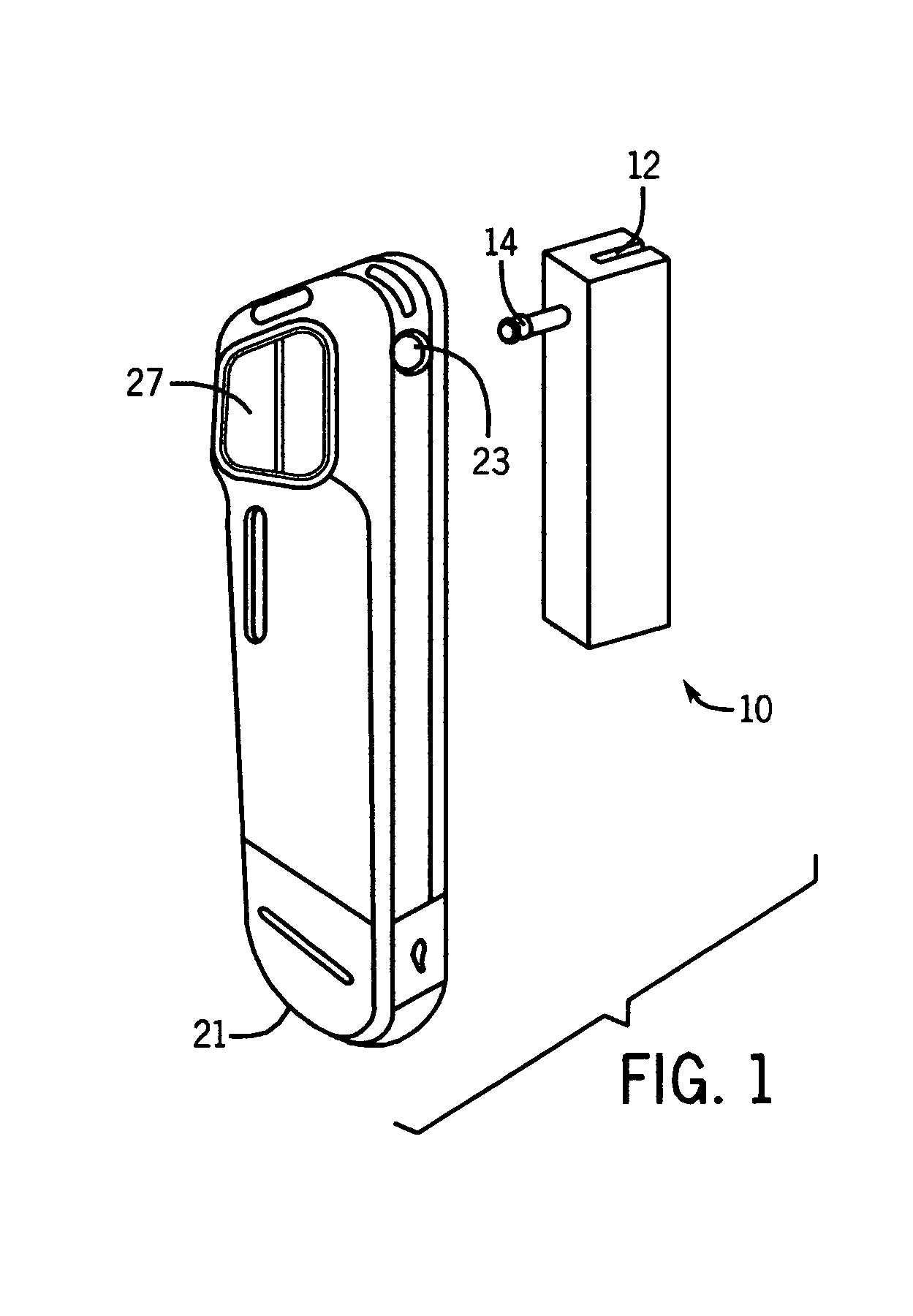

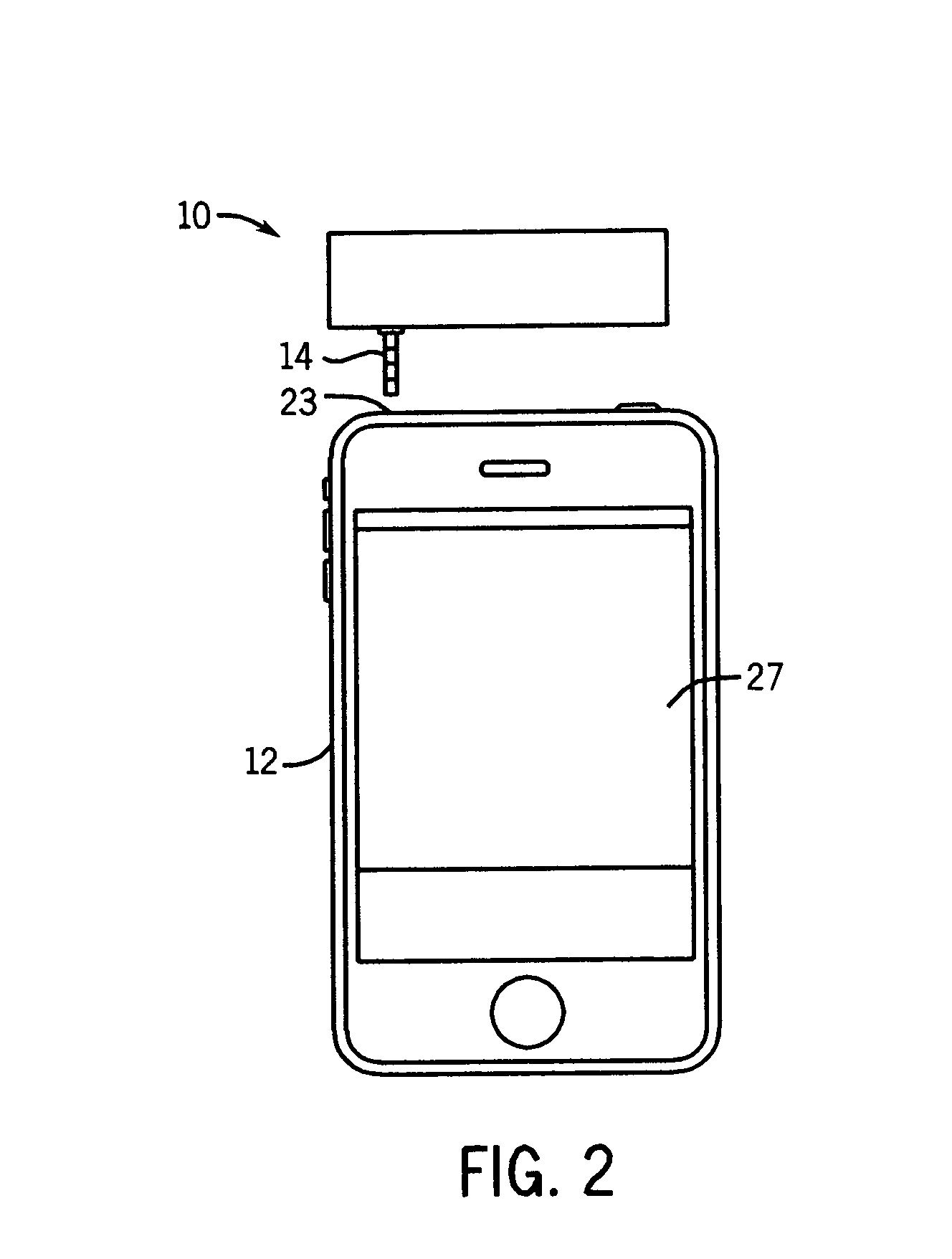

InactiveUS20120008851A1Easy to captureEasy to depositCharacter and pattern recognitionData informationElectronic instrument

An electronic method and device are provided to facilitate the capture of Magnetic Ink Character Recognition (MICR) data information present on negotiable instruments. As an input device, a MICR reader capable of reading magnetic ink character recognition data is provided. As an output channel, an audio jack adapted to be plugged into an audio port of a mobile phone is provided. The device is attached to an audio port of a mobile phone. A negotiable instrument is swiped through the MICR reader. If the amount of the negotiable instrument is not included in the MICR data, the amount of the negotiable instrument is entered into the mobile phone. The MICR data and amount of the negotiable instrument are transmitted to create an electronic instrument.

Owner:APTYS SOLUTIONS

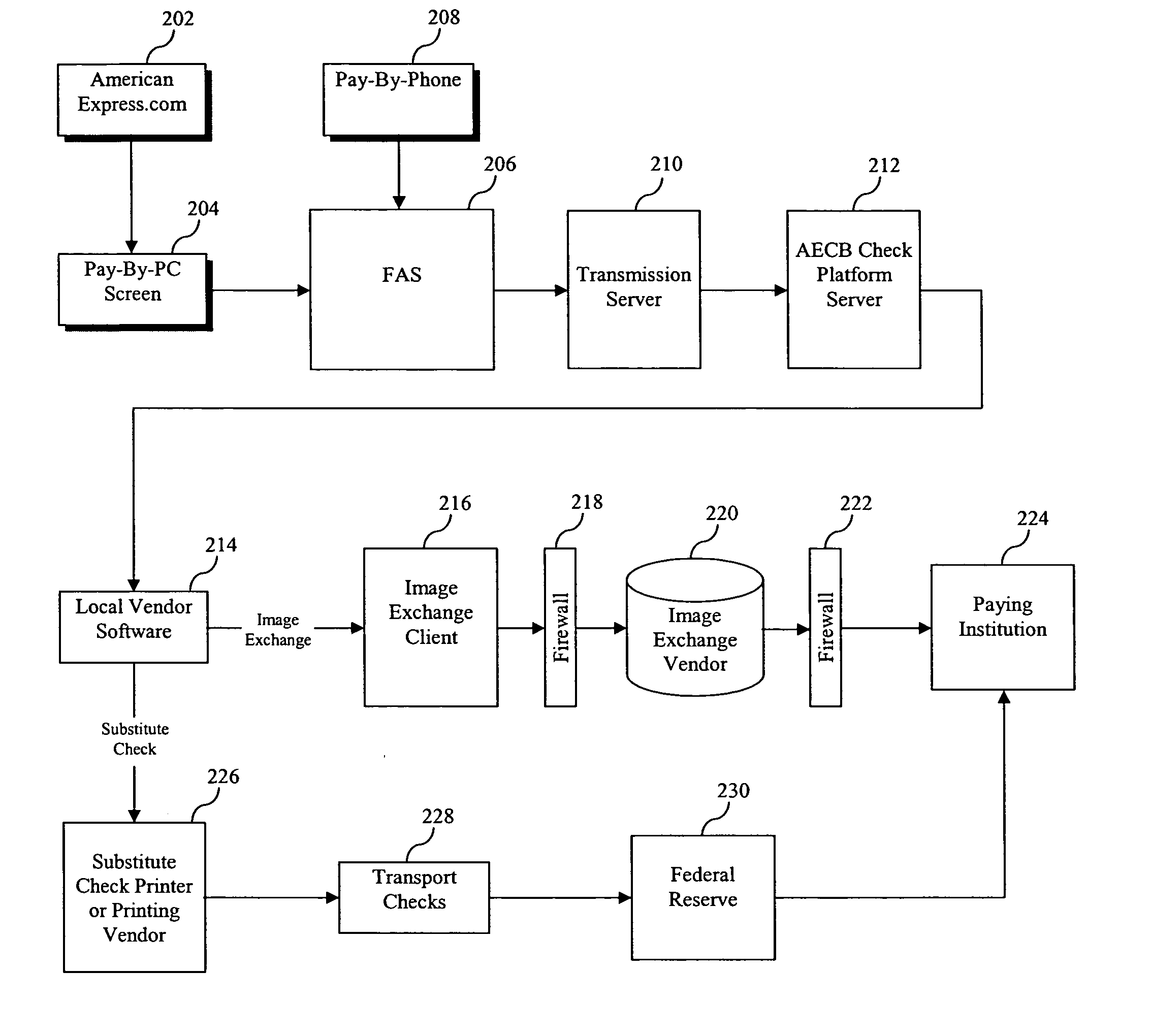

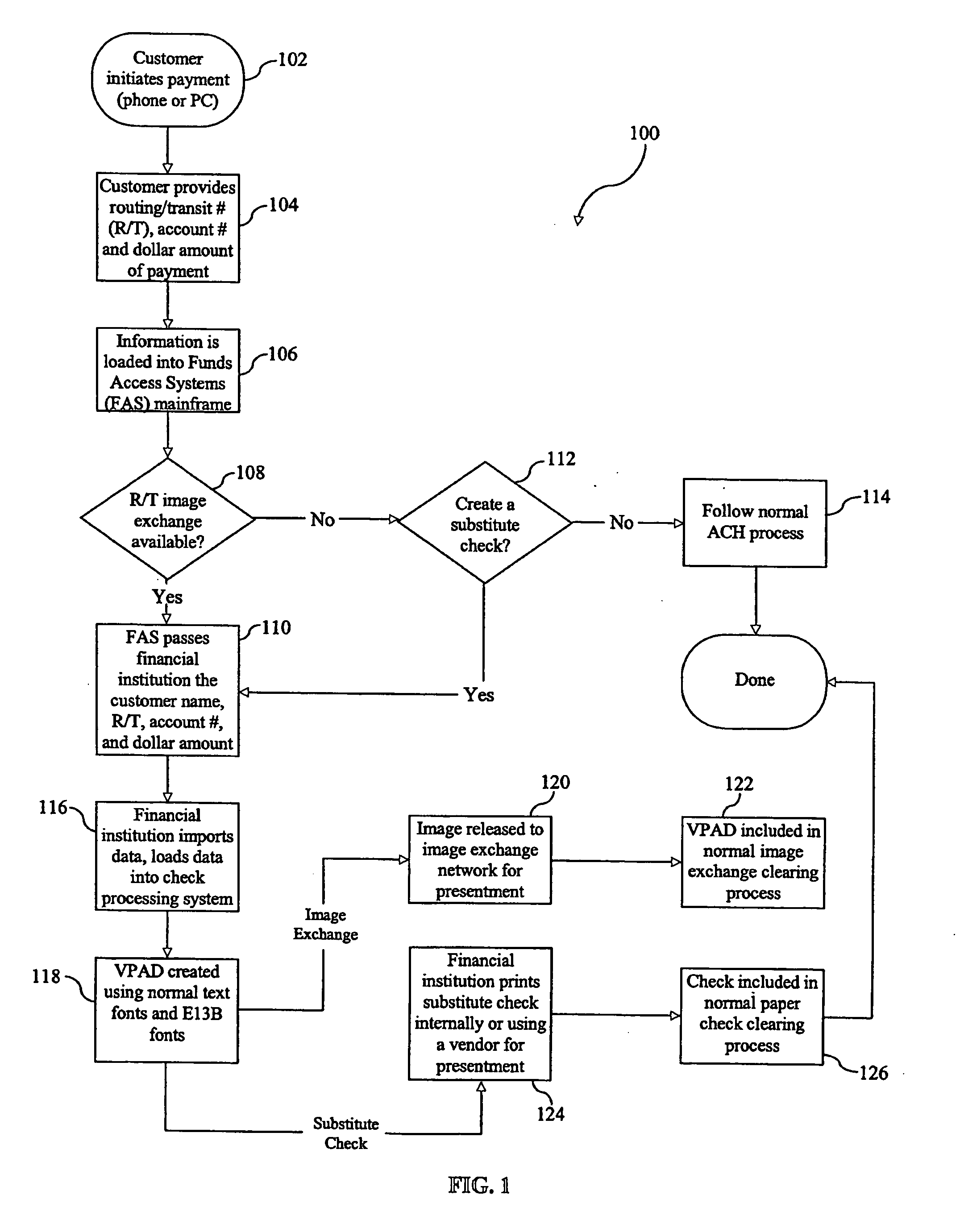

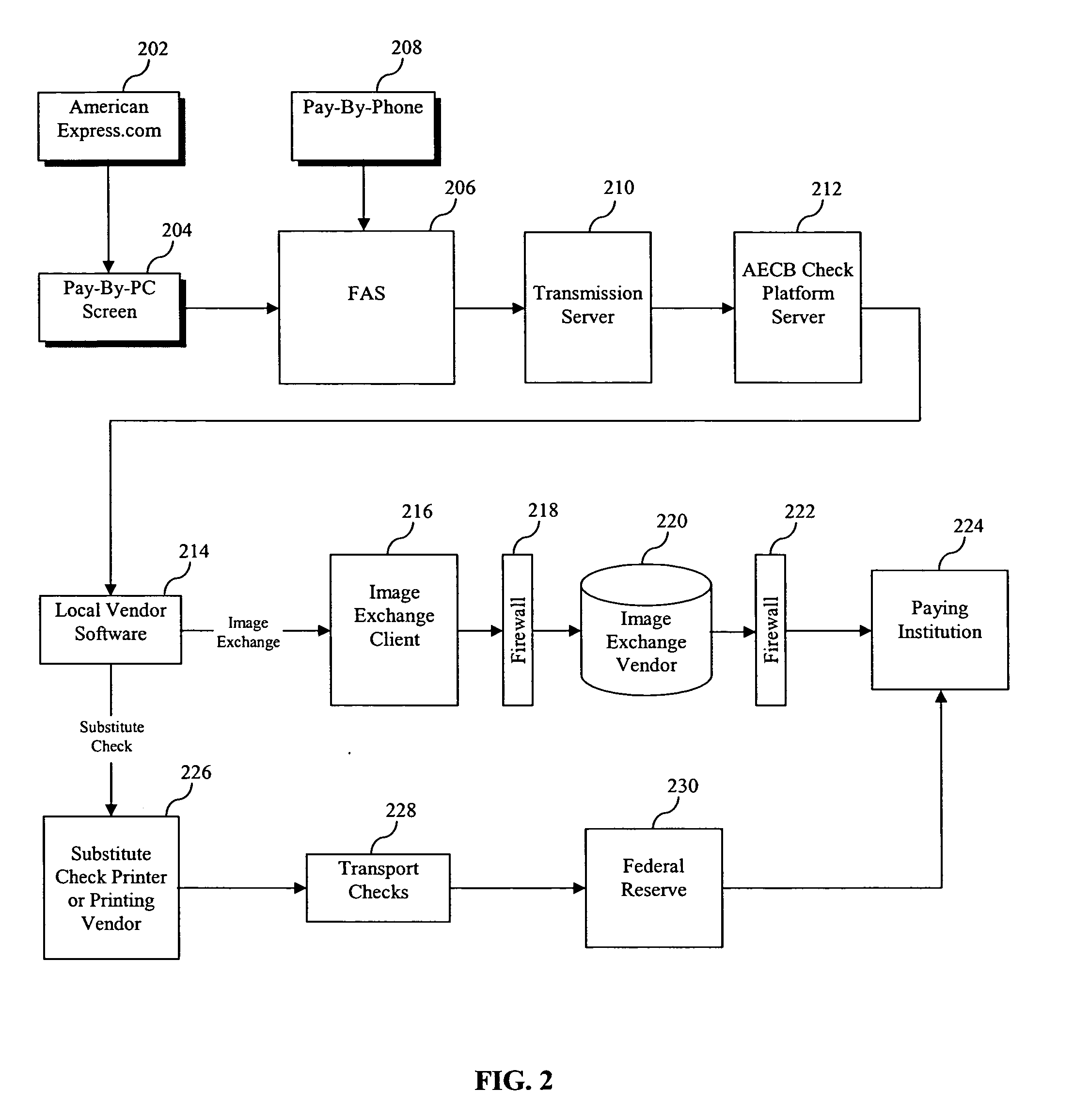

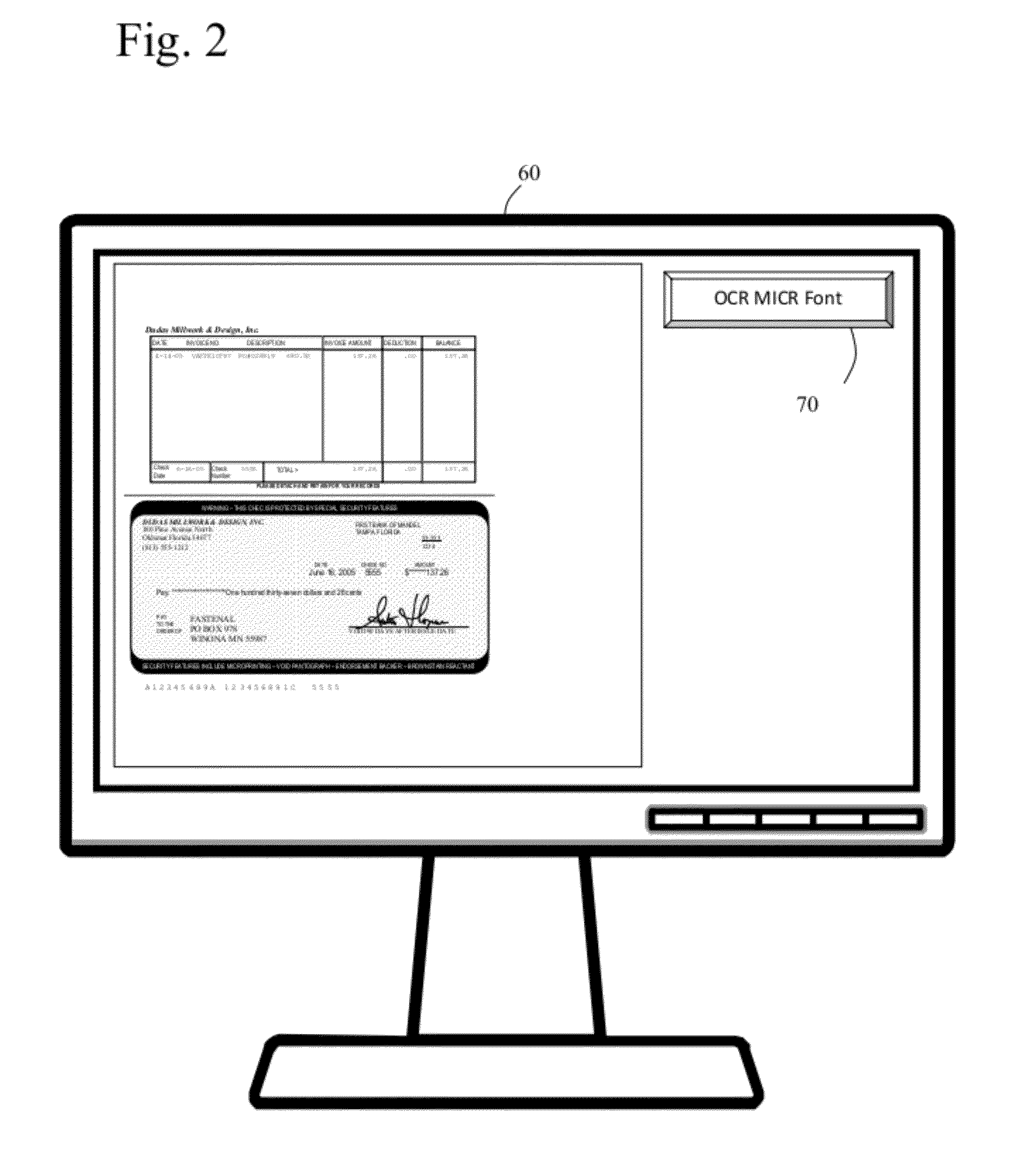

System, method, and computer program product for processing payments with a virtual preauthorized draft

An image-based check processing software has the ability to create an electronic check form to be displayed, printed and / or exported to a file. Using various text fonts, such as the Magnetic Ink Character Recognition (MICR) font, a new electronic form has been created from text data that has all the characteristics of a preauthorized draft. As computer and phone payments are processed by a financial institution, the virtual draft will be created if the routing / transit numbers of the paying institution accept images of checks as presentment through, for example, an image exchange program or the eventual printing of a substitute check. The transactions will then be routed to the financial institution who will import the necessary data to create the virtual check. The image will then be presented for payment.

Owner:LIBERTY PEAK VENTURES LLC

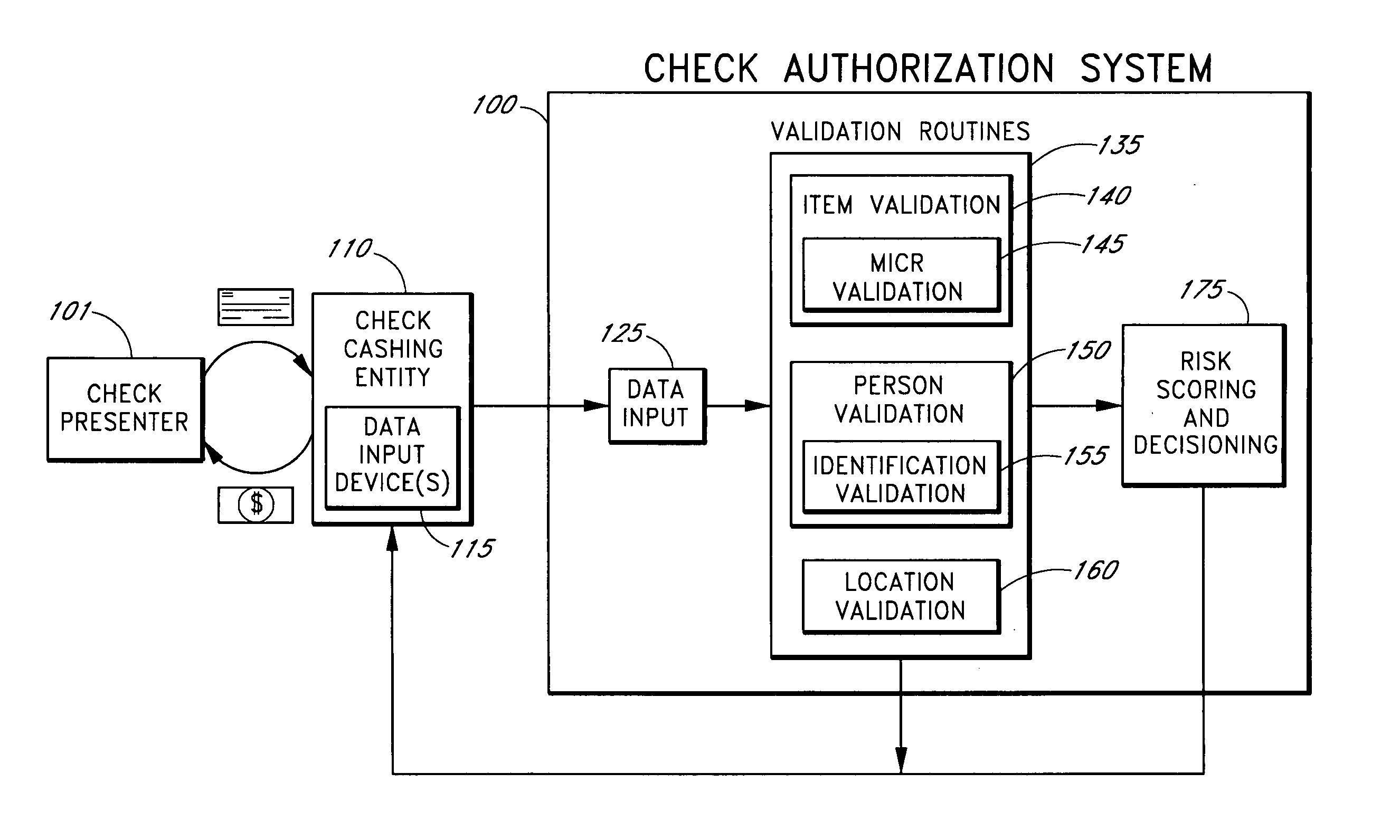

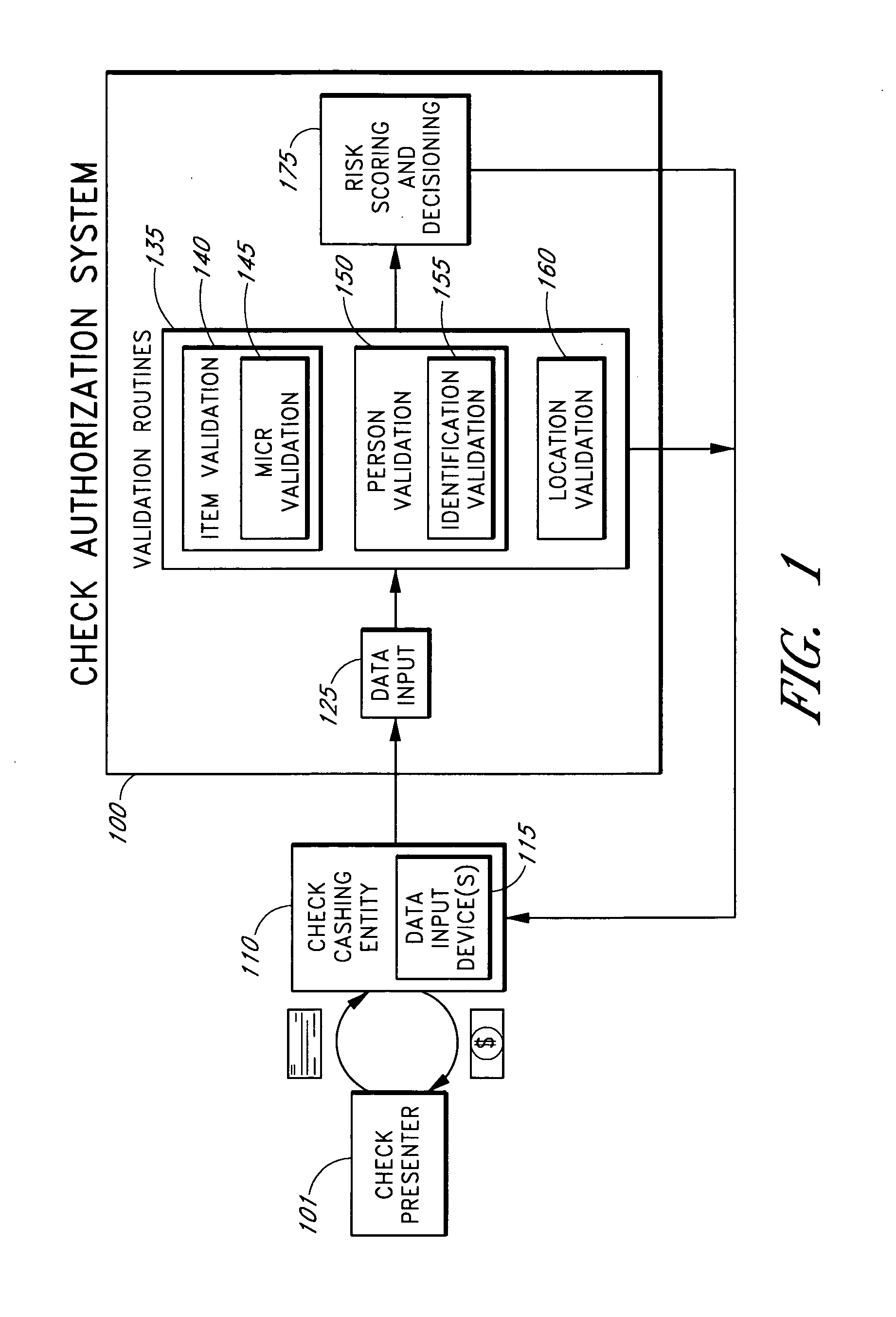

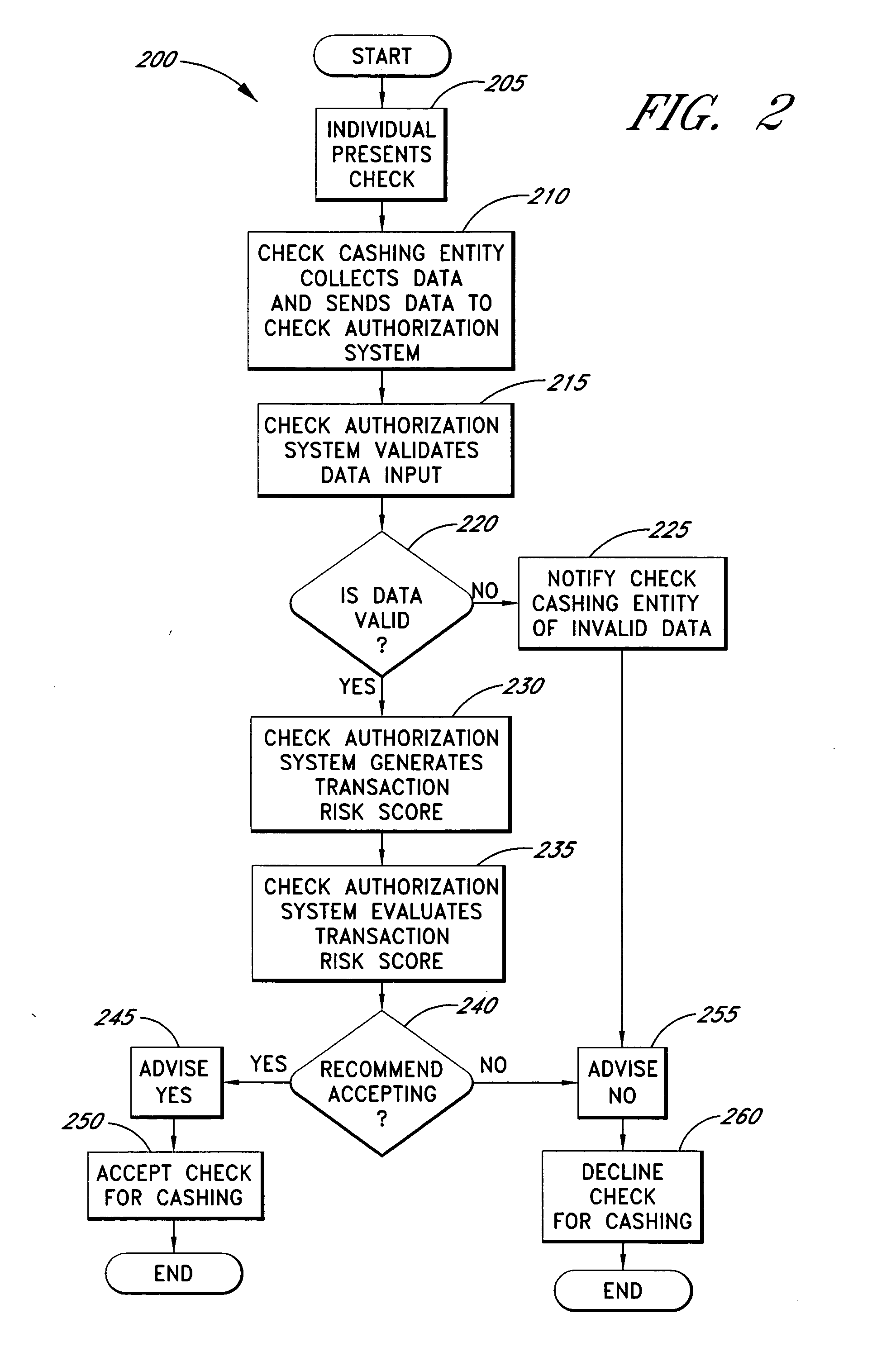

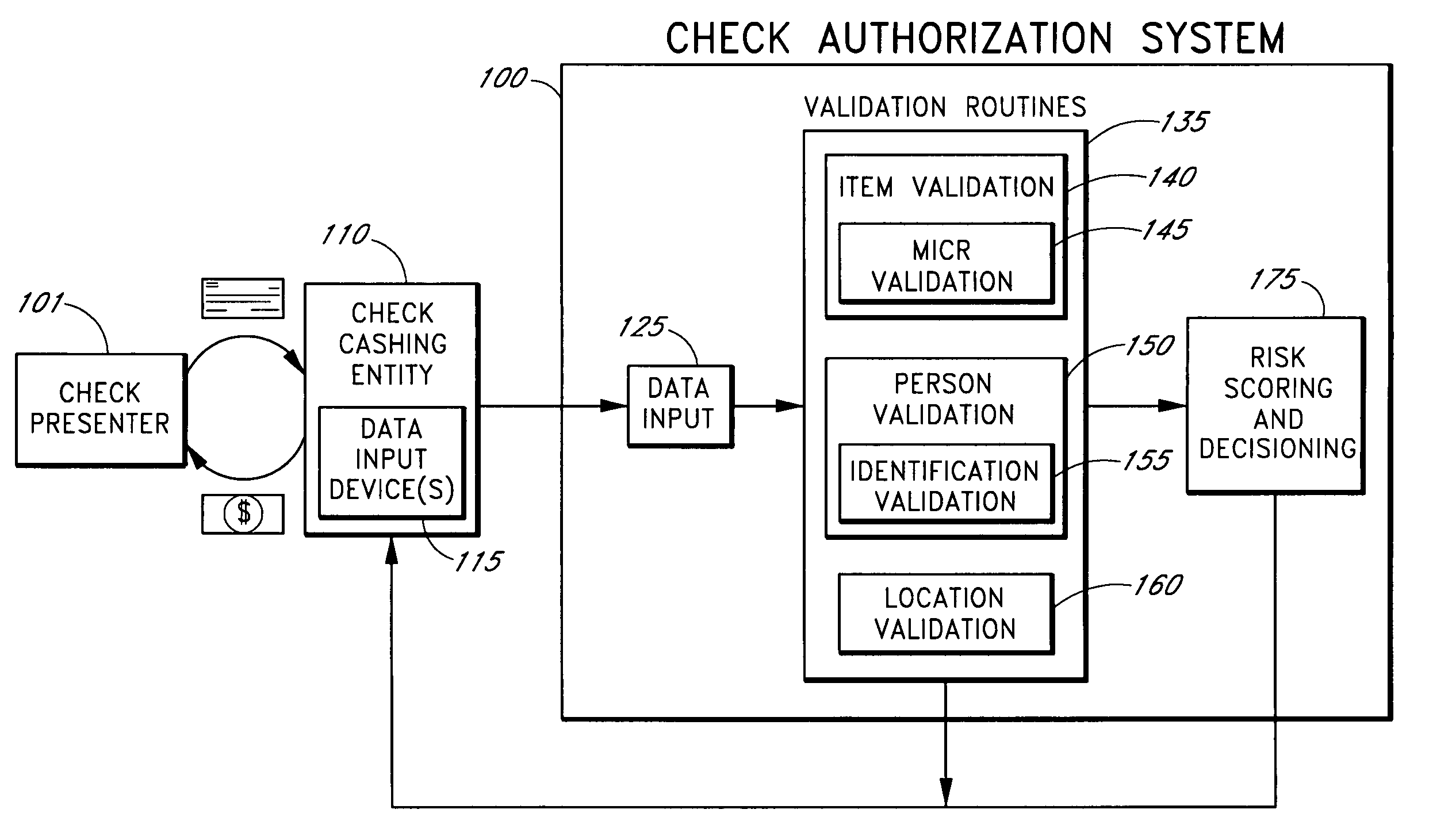

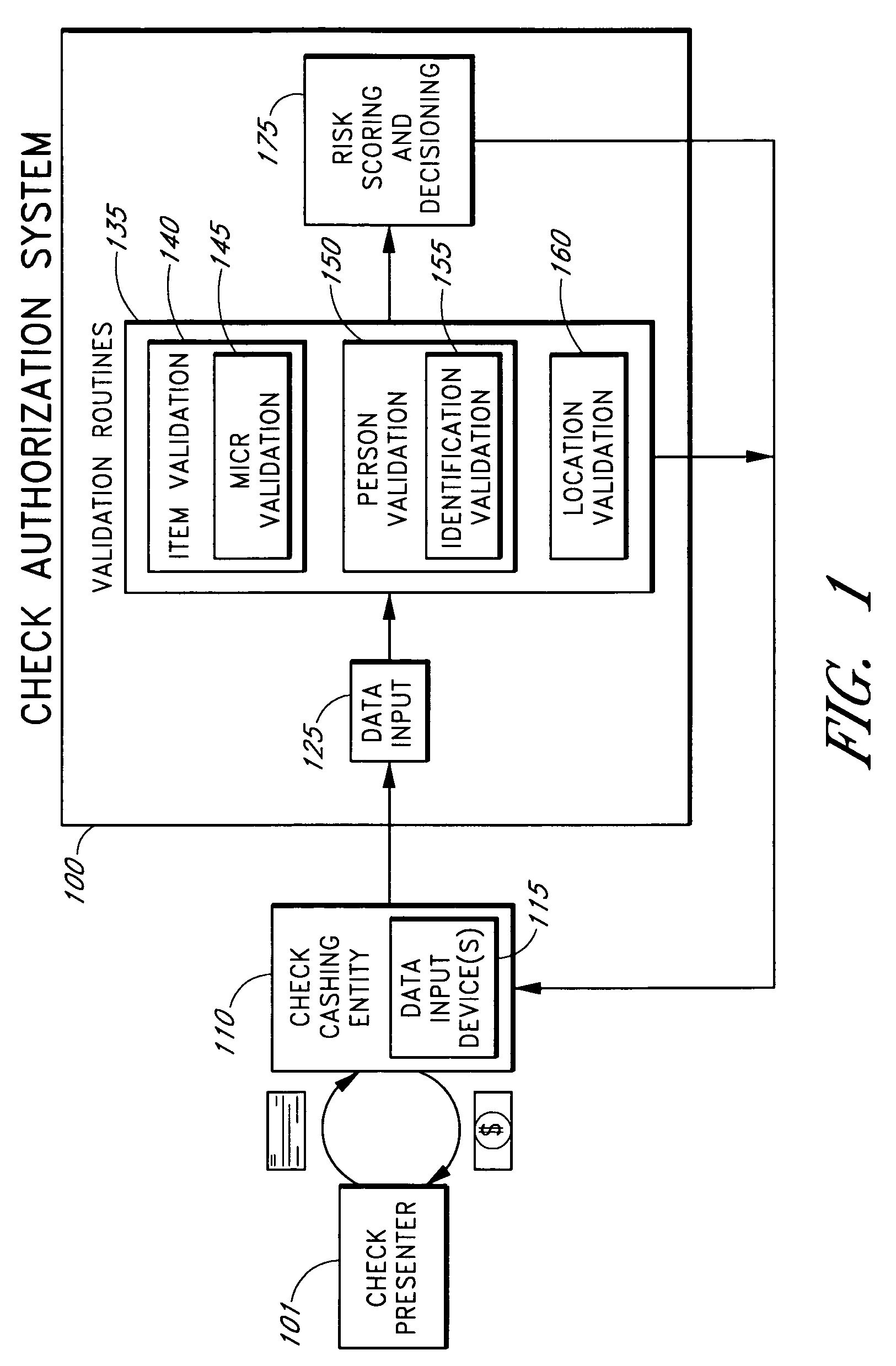

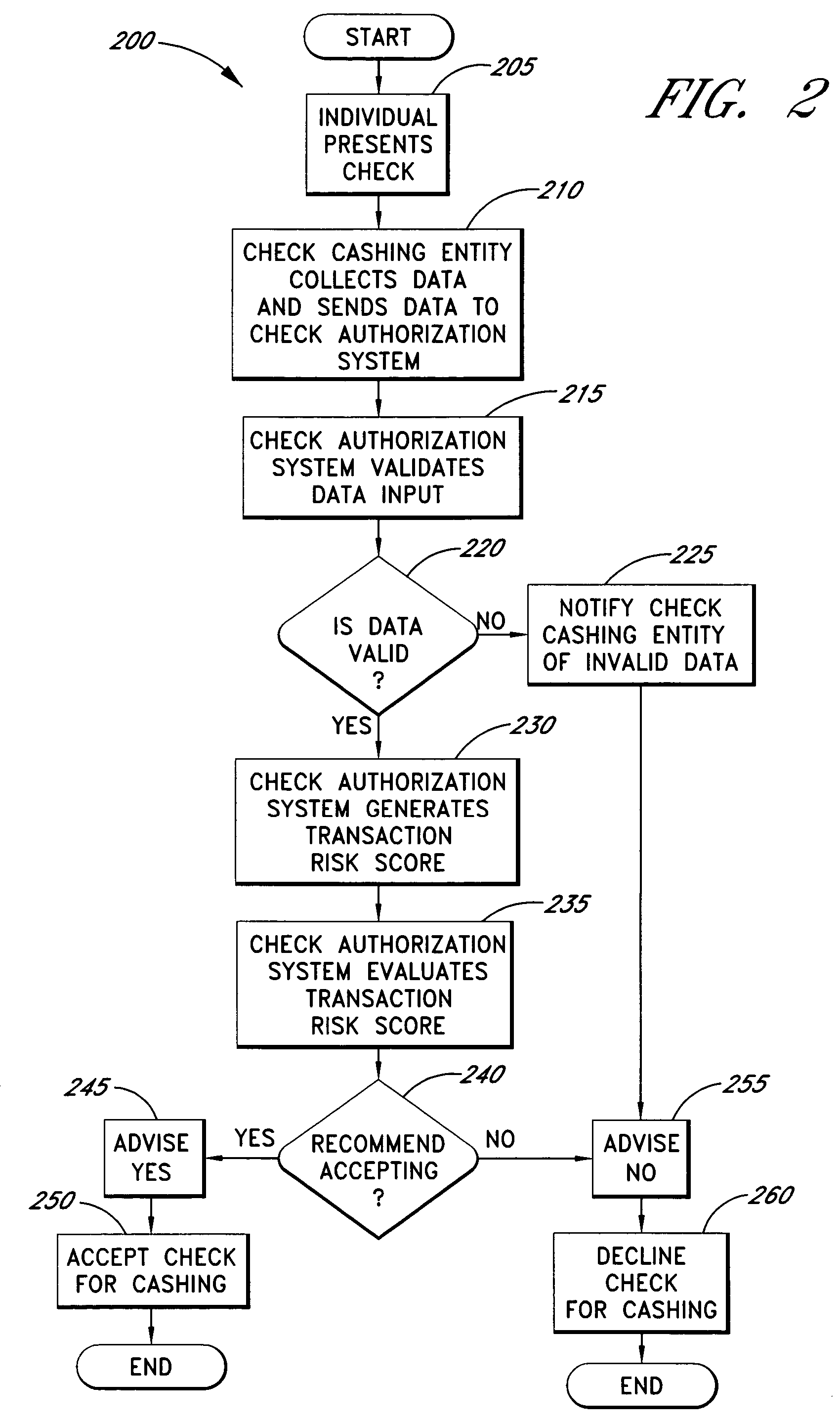

Systems and methods for identifying payor location based on transaction data

Systems and methods are described for building, maintaining, and using a repository of information about payors of second-party checks presented at a check-cashing entity for cashing. In various embodiments, the repository comprises stored information useful for determining the location of a payor of a second-party check. In one embodiment, information from the check that identifies an account on which the check is drawn, such as magnetic ink character recognition (MICR) line information from a paycheck, is used to access a repository of employer location information. In one embodiment, the payor location information is used to determine a proximity between the payor location and the check cashing entity location. In one embodiment, when a check is presented for which stored payor location information is not available, identifying information about the payor and / or the payor location is requested and is added to the repository.

Owner:FIRST DATA

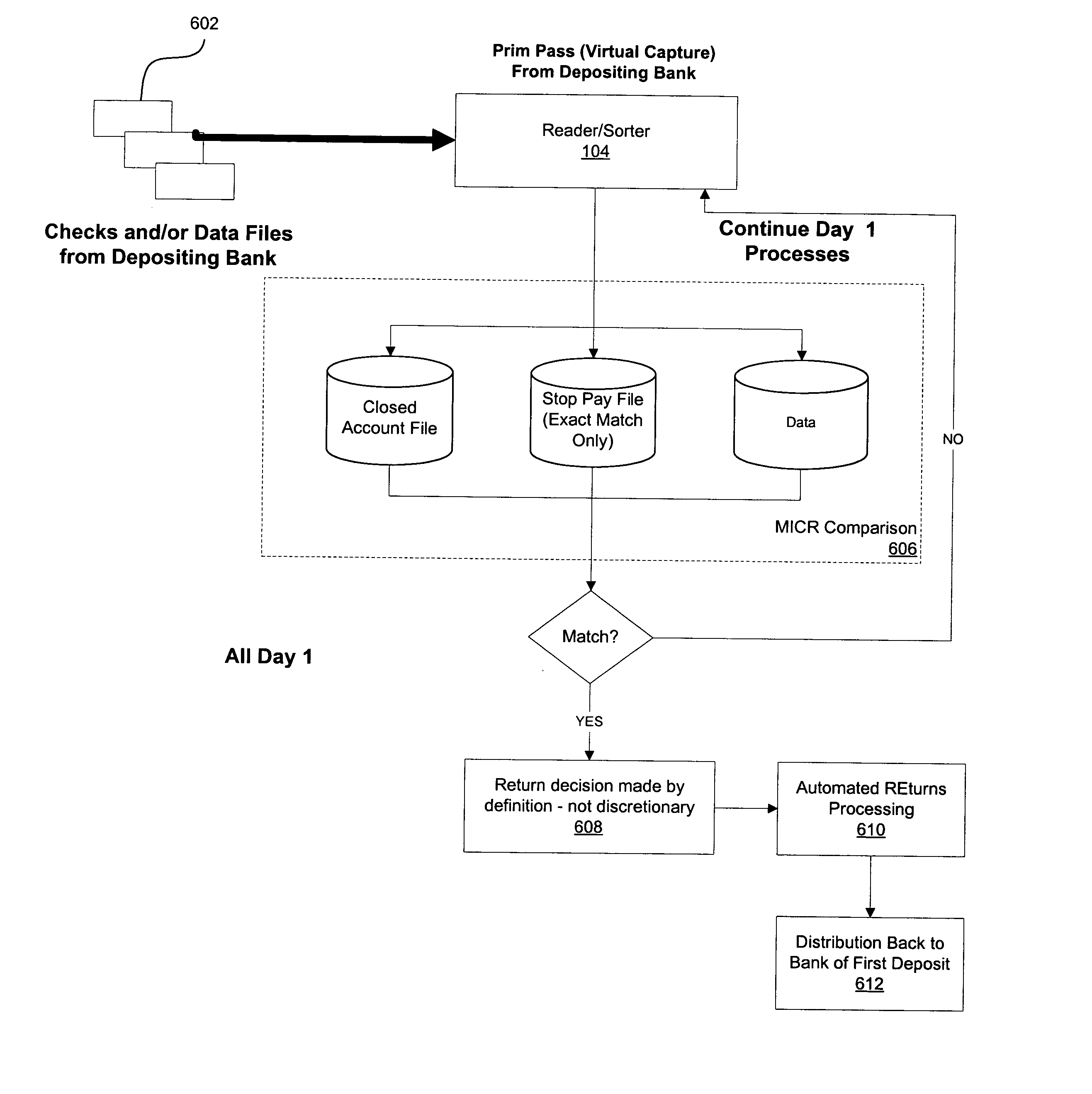

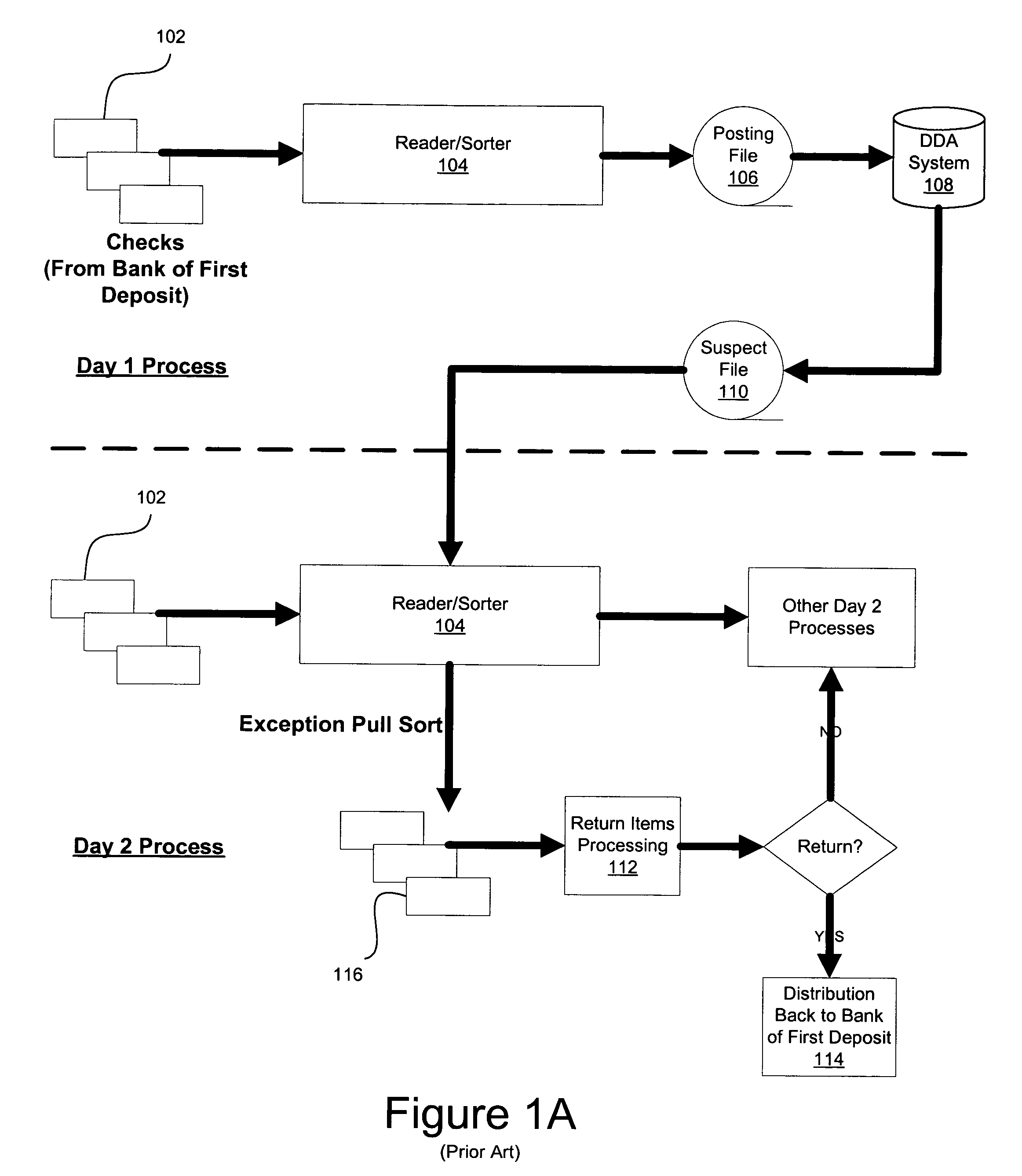

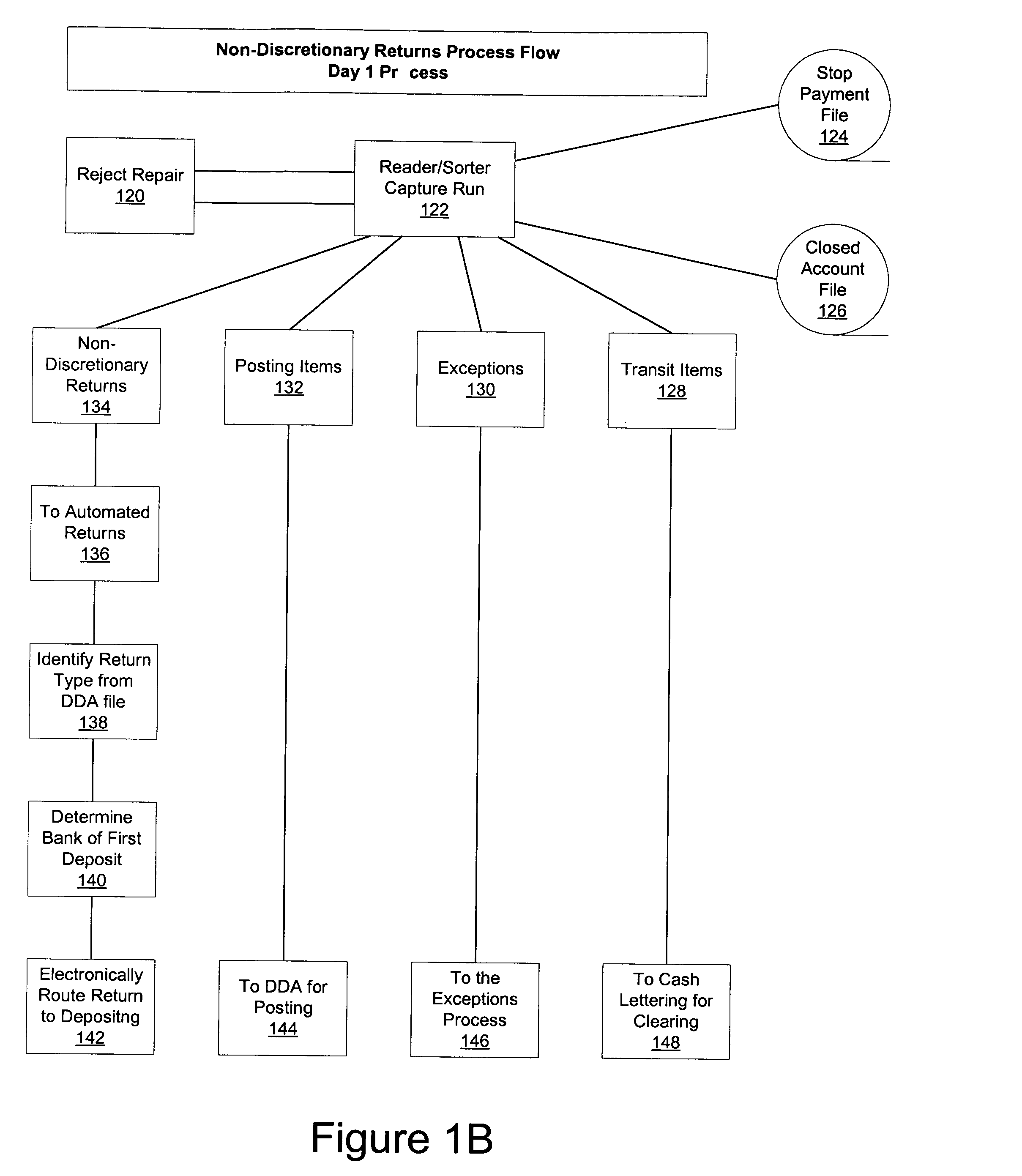

Process and method for identifying and processing returned checks

A method, system, and computer program product for processing checks is provided. In one embodiment, a plurality of checks from a variety of banks of first deposit are fed through a reader / sorter. The magnetic ink character recognition data is captured from one of the plurality of checks. Alternatively, a check image is received from a bank and the magnetic ink character recognition data is determined from the check image. The magnetic ink character recognition data is compared to stored bank data to determine whether the check should be returned to a bank of first deposit. Responsive to a determination that the check does not match return criteria specified in the stored bank data, the check is posted to a demand deposit account. Responsive to a determination that the check does match return criteria specified in the stored bank data, a return to the bank of first deposit procedure is initiated.

Owner:ELECTRONICS DATA SYST CORP

Magnetic toner and conductive developer compositions

Magnetic toner compositions, conductive developer compositions, and methods for producing images in a hybrid jumping development system, more specifically, in a magnetic ink character recognition system, are disclosed. The developer compositions contain coated magnetic toner particles and coated carrier particles. The toner compositions include a resin, colorant, wax, magnetic component, and surface additives of coated silica, titania, and zinc stearate.

Owner:XEROX CORP

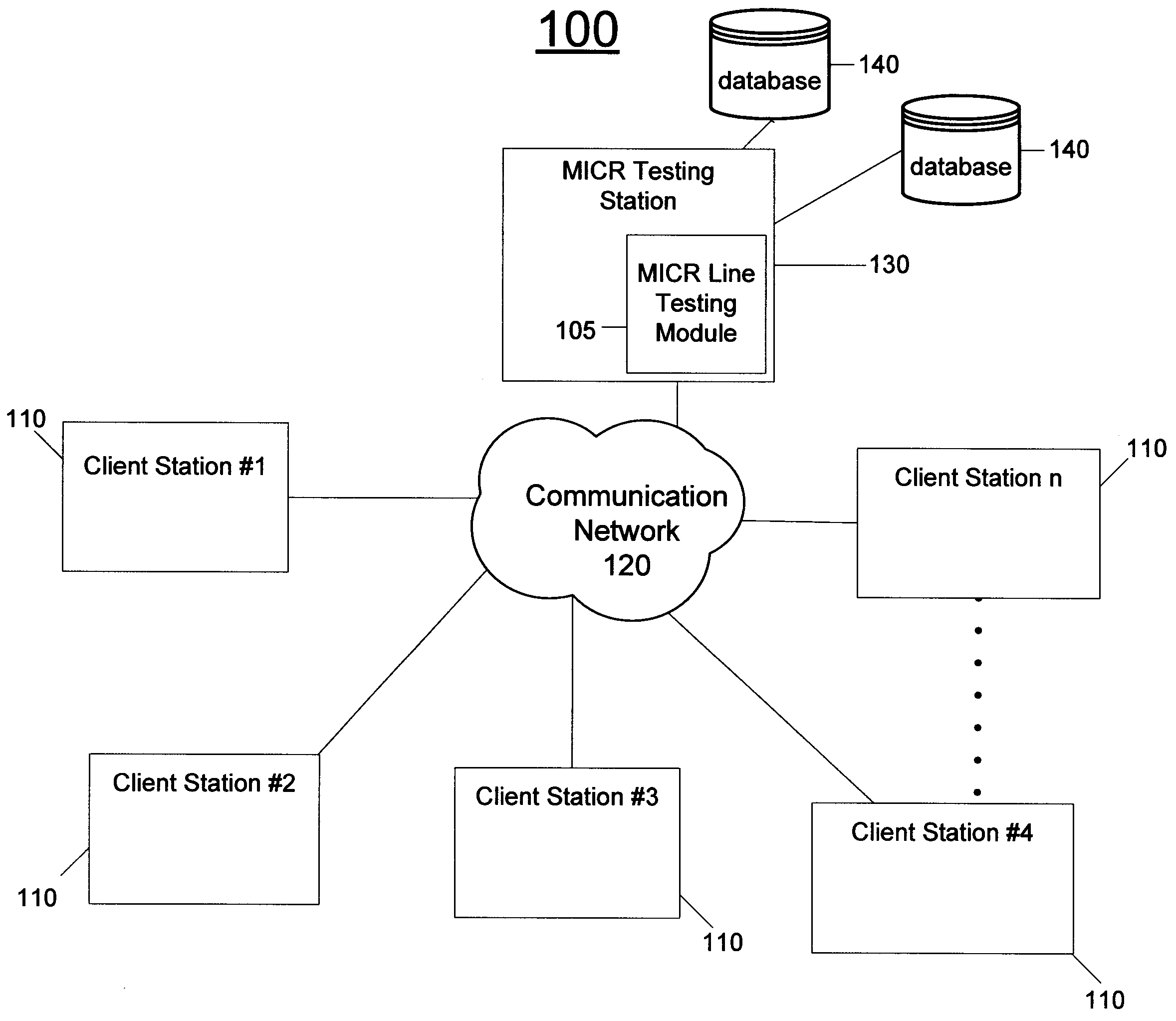

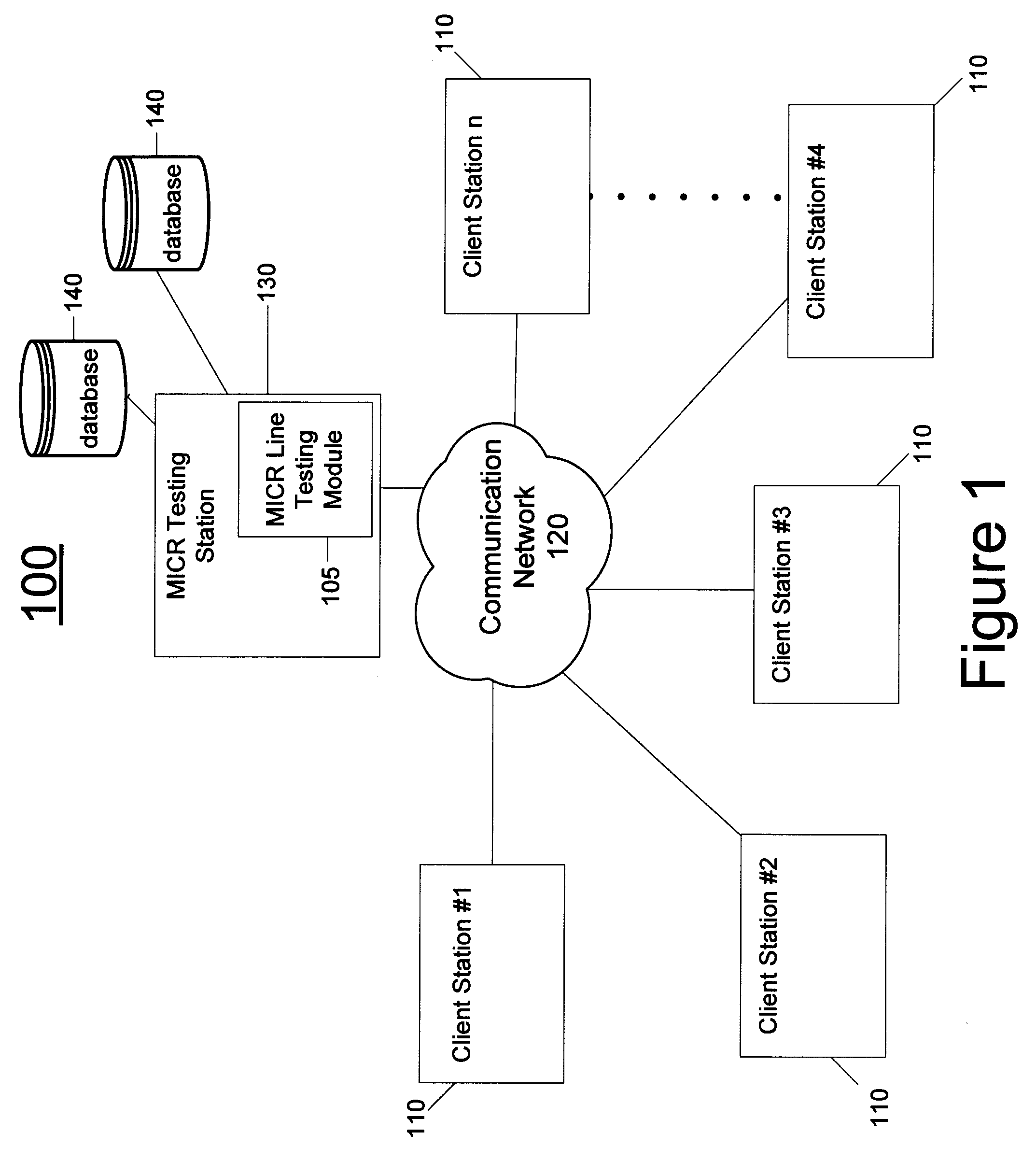

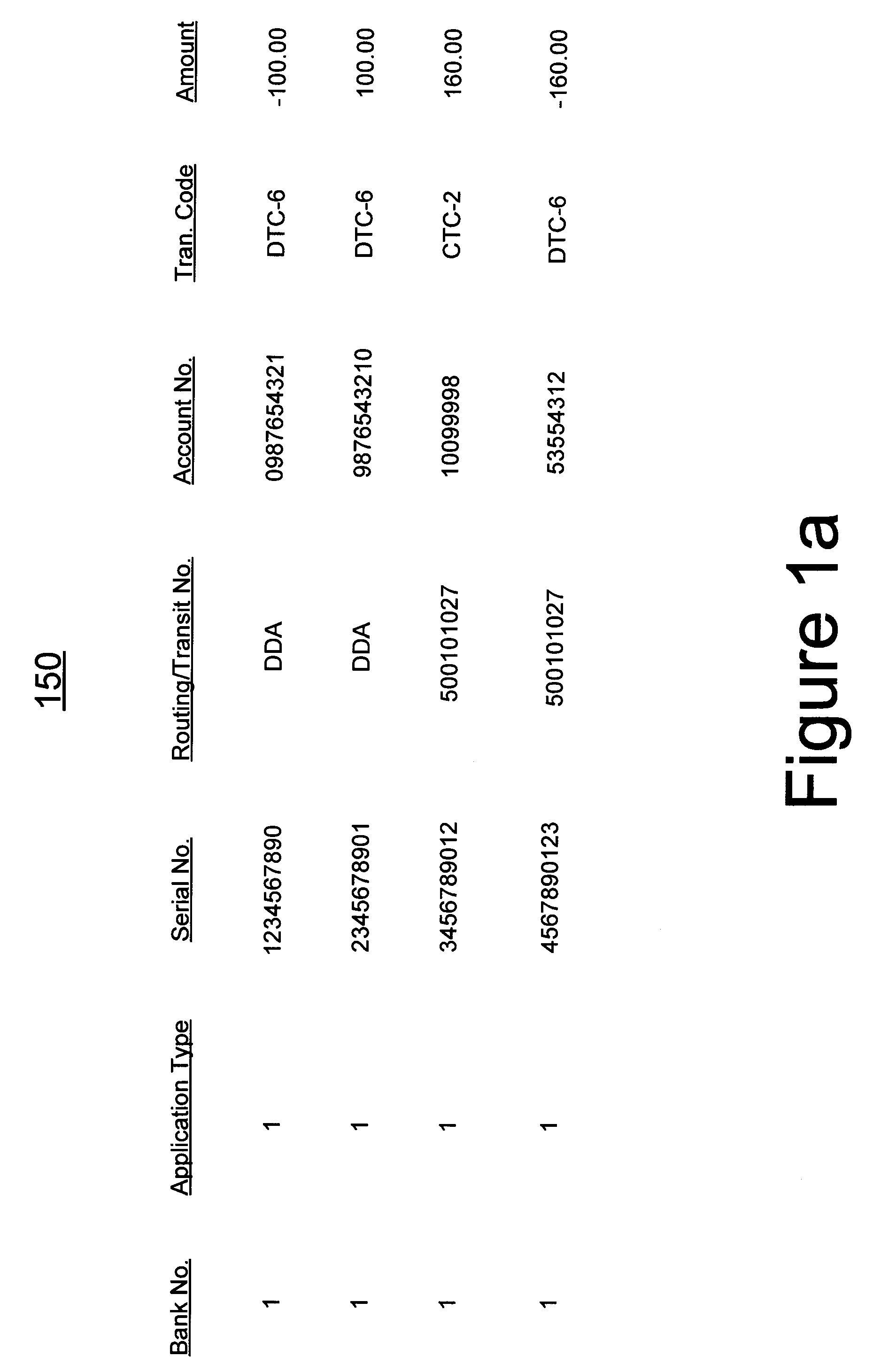

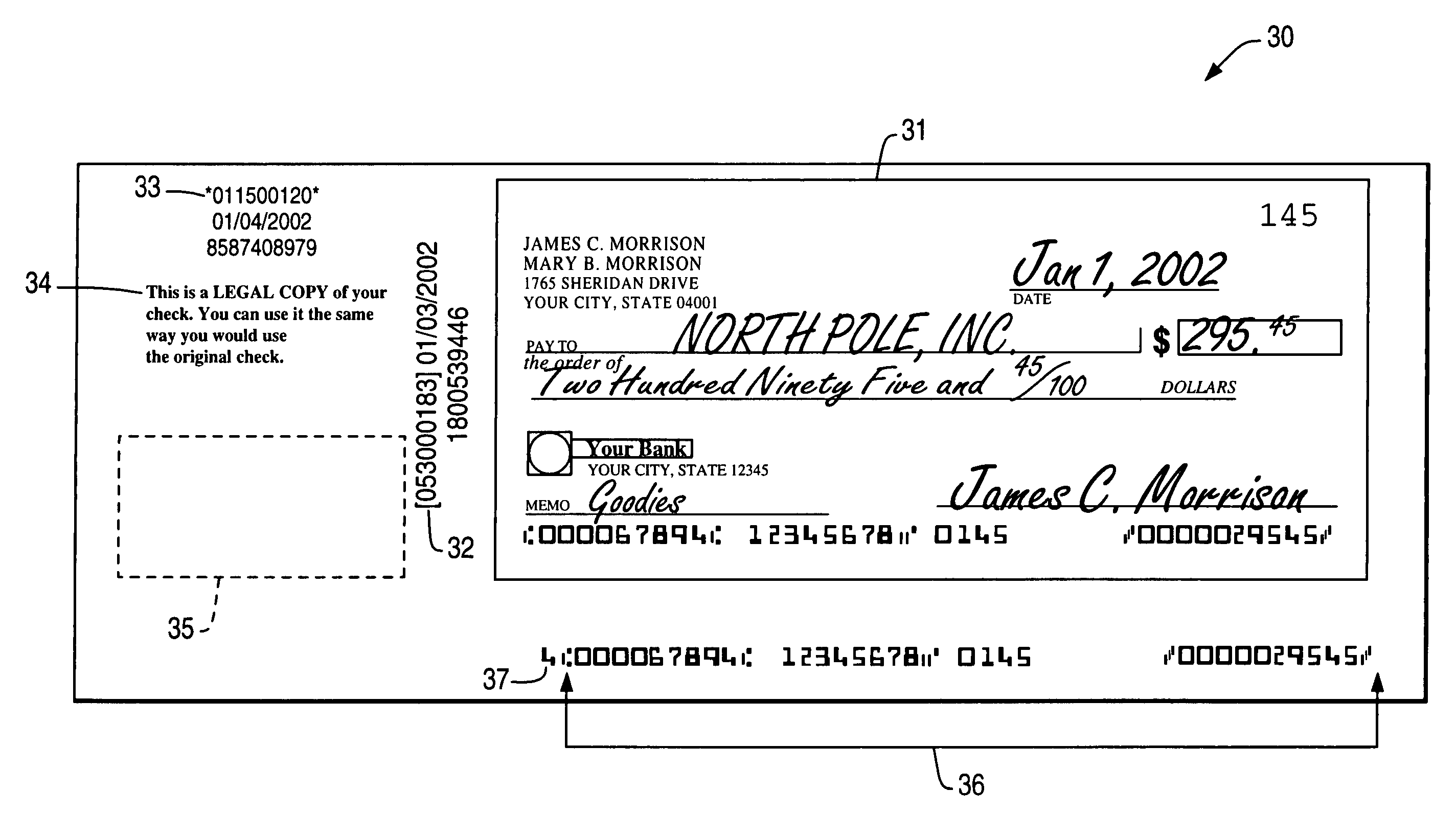

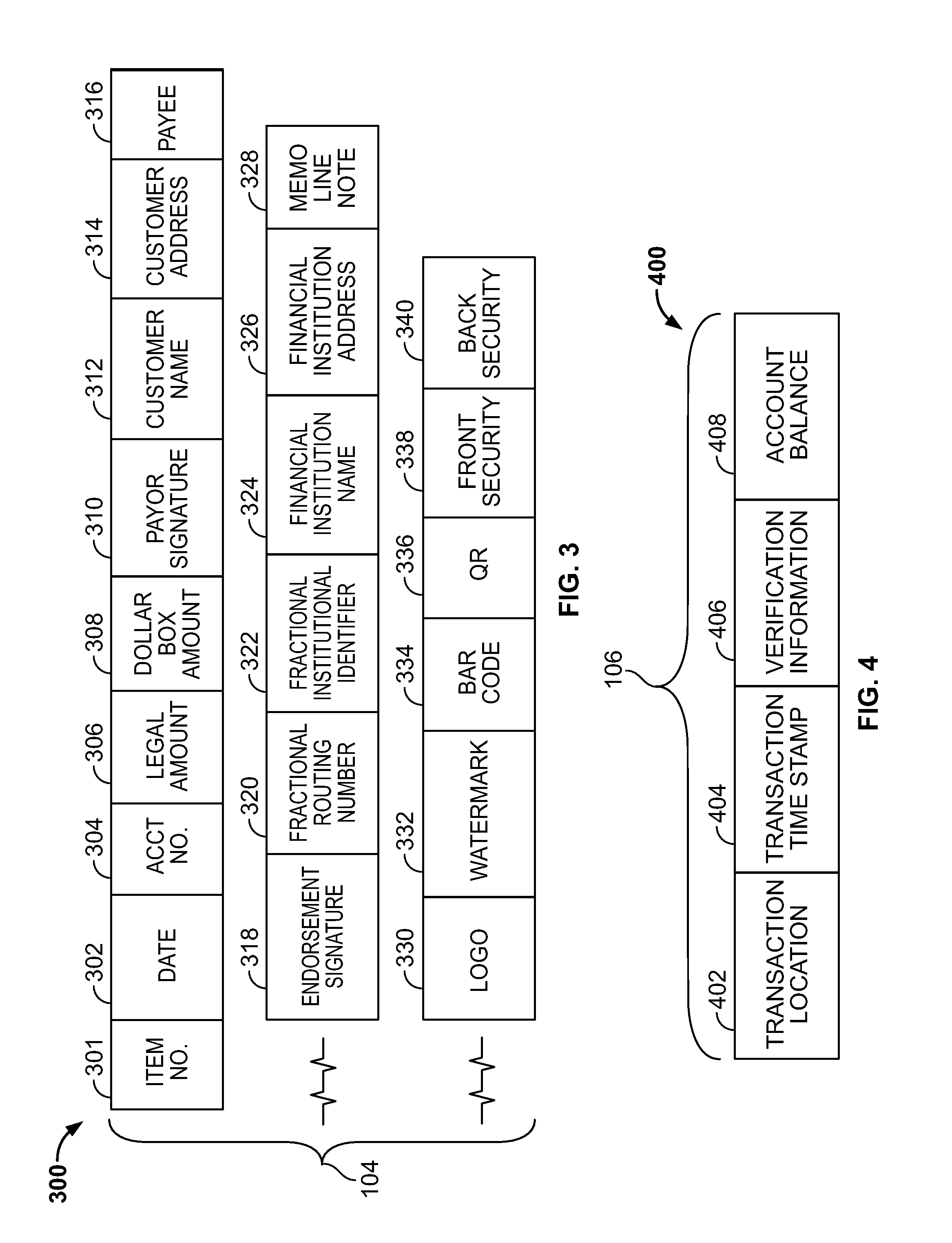

System and Method for Generating Magnetic Ink Character Recognition (MICR) Testing Documents

ActiveUS20080193008A1Exact correlationAccelerated programFinanceCharacter and pattern recognitionTest documentNetwork connection

A system and method for accessing data to generate documents for use in MICR line testing. The system comprises a MICR testing station for testing MICR processing. The MICR testing station comprises a MICR line testing module for generating at least one MICR testing document for use in testing MICR processing. The MICR line testing module further comprises: (1) an application determination module for determining an application based on a bank selection provided by a tester, (2) a routing / transit number determination module for determining a routing / transit number based on the bank and the application determined, and (3) a tran code determination module for determining a tran code based on the routing / transit number determined; and at least one client station connected to the MICR testing station via a communications network, the at least one client station being used by at least one tester to provide particulars about at least one MICR line.

Owner:JPMORGAN CHASE BANK NA

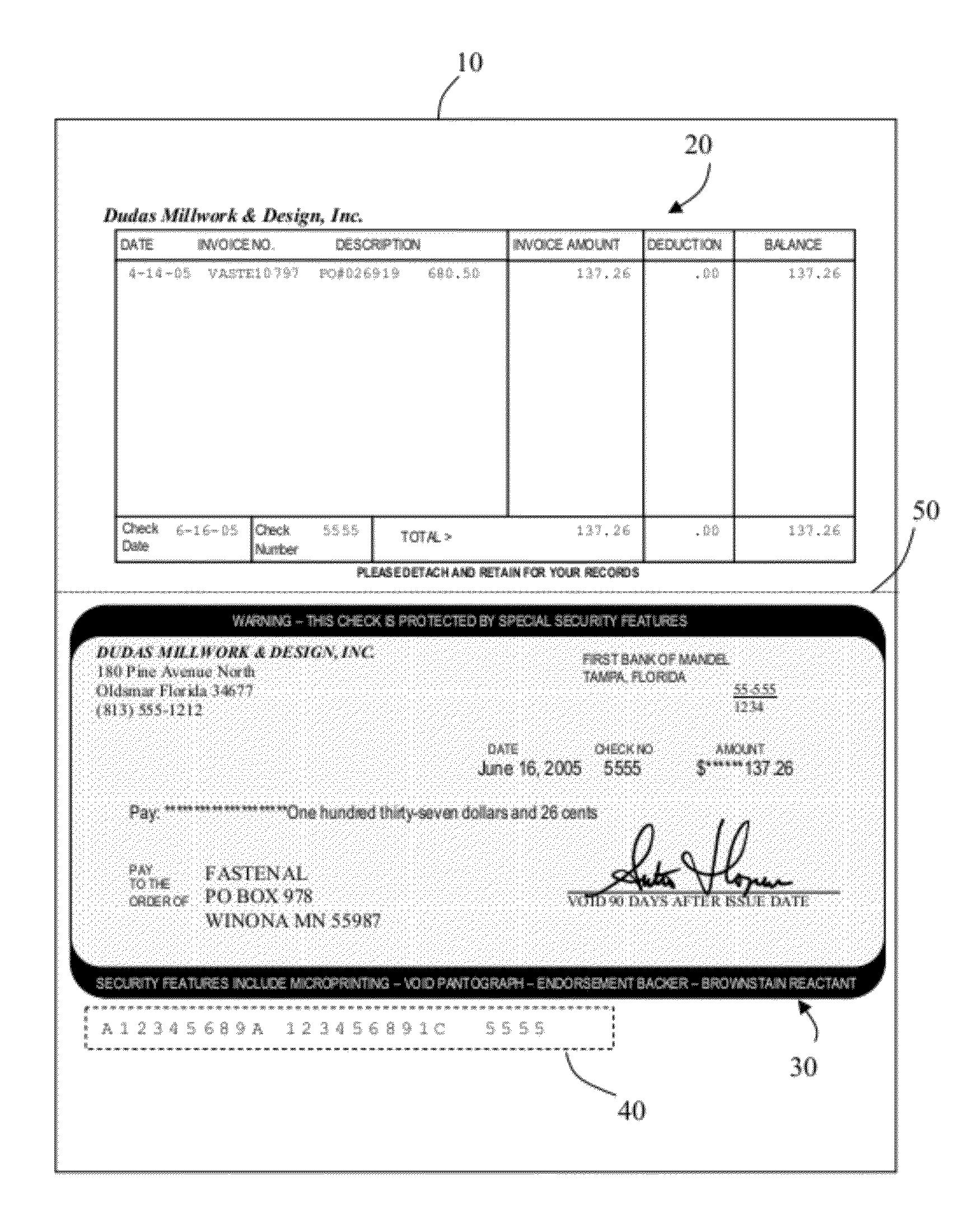

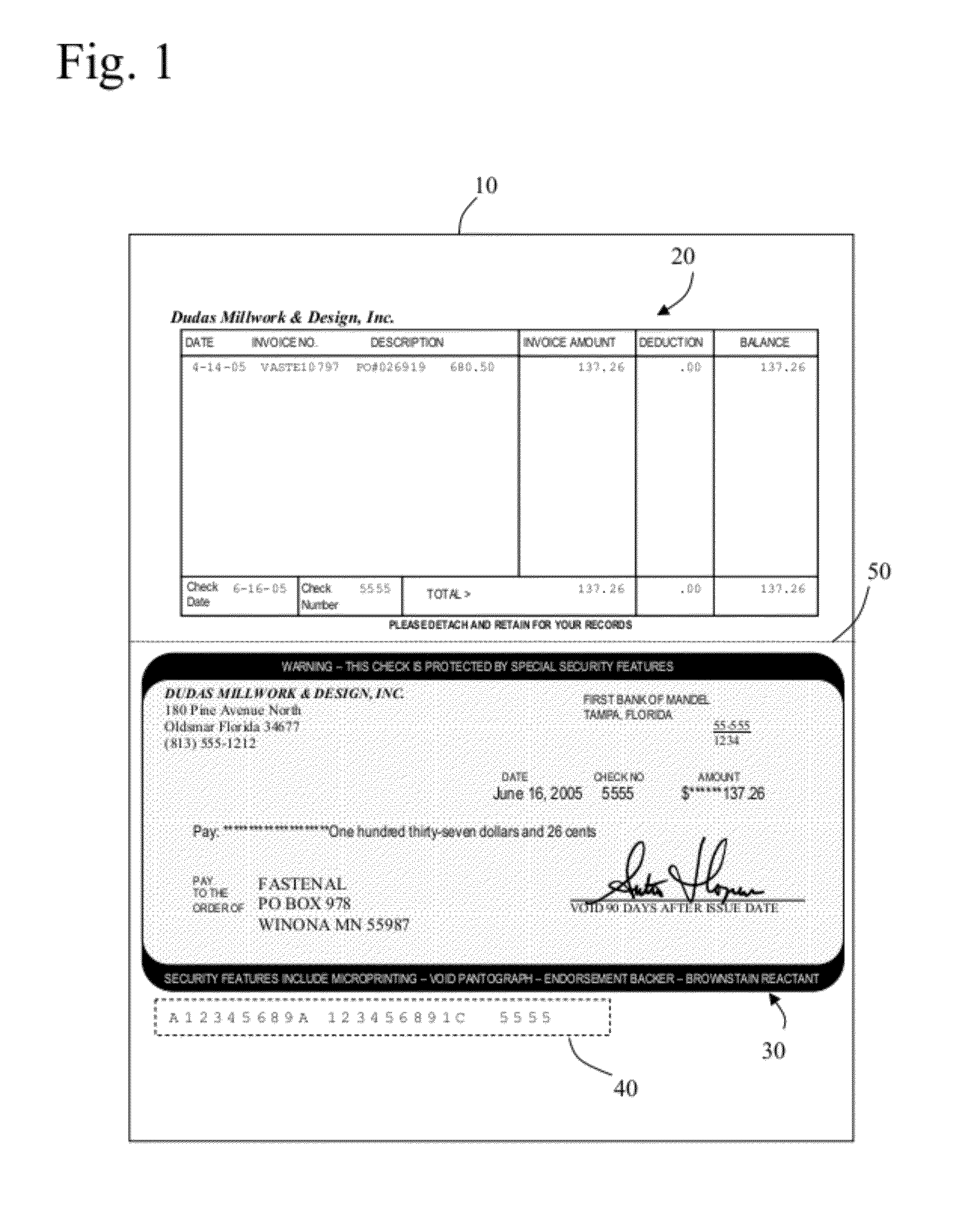

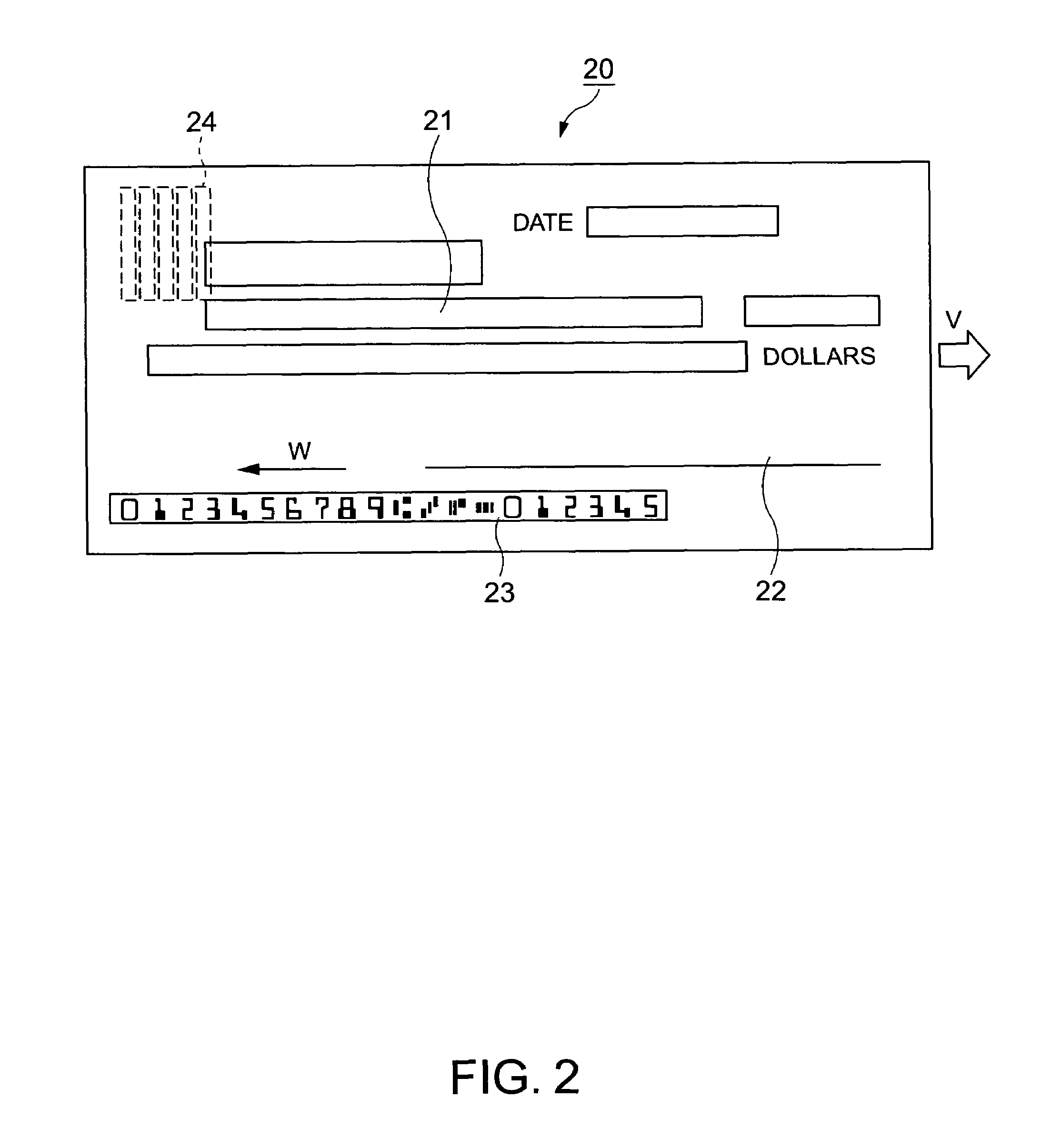

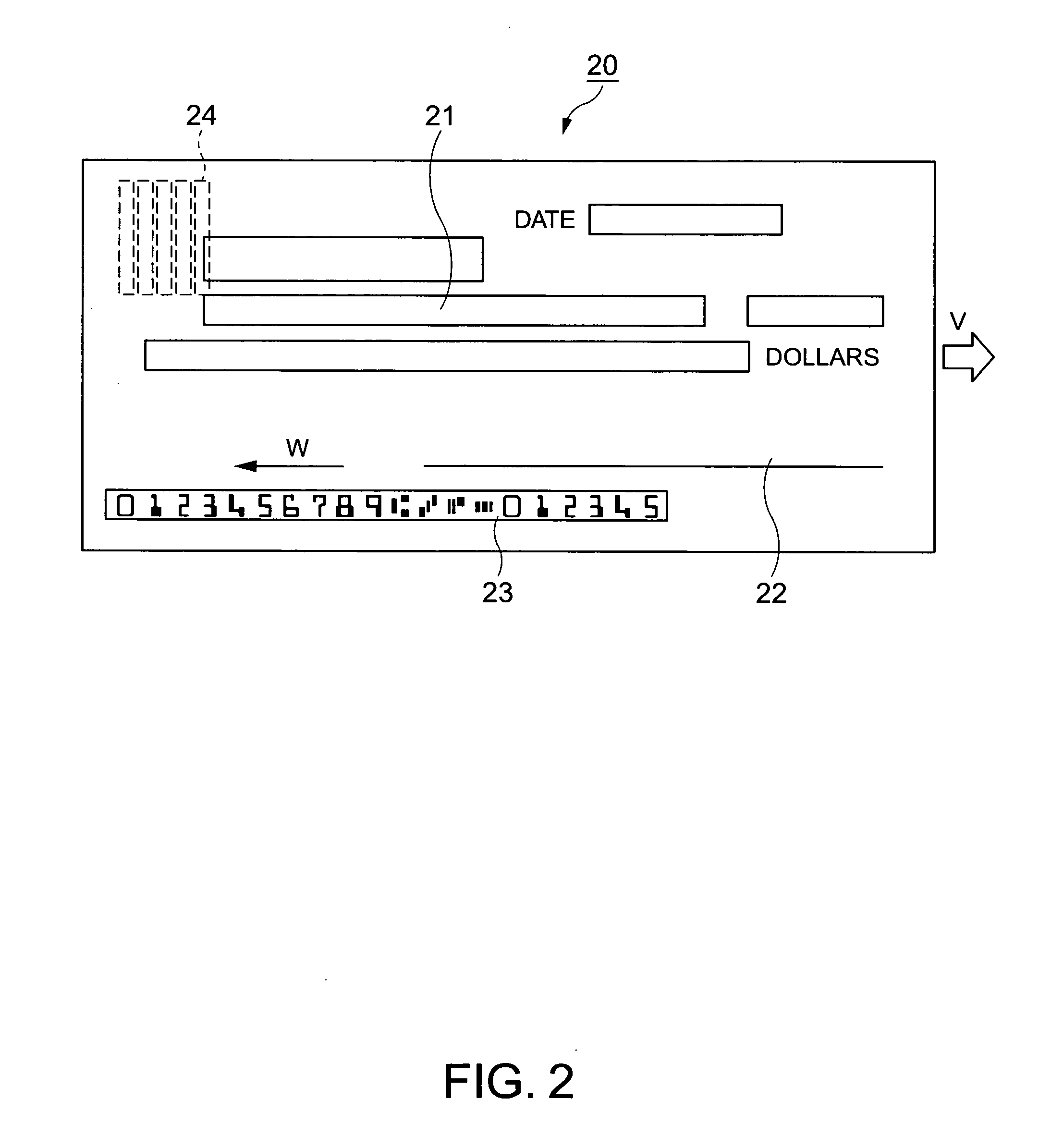

Method of creating an image replacement document for use in a check truncation environment and an apparatus therefor

A method of creating an image replacement document (IRD) during two passes of a sheet material through a printing apparatus including building a first print file portion based upon IRD data, building a second print file portion based upon IRD data, printing with non-magnetic ink onto the sheet material at least some information based upon the first print file portion to create a front portion of the IRD during a first pass of the sheet material through the printing apparatus, printing with non-magnetic ink onto the sheet material a machine-readable code which is associated with a magnetic ink character recognition (MICR) codeline to be encoded onto the IRD, printing with non-magnetic ink onto the sheet material at least some information based upon the second print file portion to create a back portion of the IRD during the first pass of the sheet material through the printing apparatus, and printing with magnetic ink onto the sheet material the MICR codeline based upon the machine-readable code which has been printed on the sheet material to print an encoded MICR codeline during a second pass of the sheet material through the printing apparatus.

Owner:NCR CORP

Check Boundary Detection by String Literal Analysis

A method of locating a check image region within a document image comprising the steps of locating a magnetic ink character recognition region of the check and calculating the top of the check relative to the magnetic ink character recognition region by detection of string literals having a historical and / or contextual relationship to the upper check boundary.

Owner:HYLAND SOFTWARE

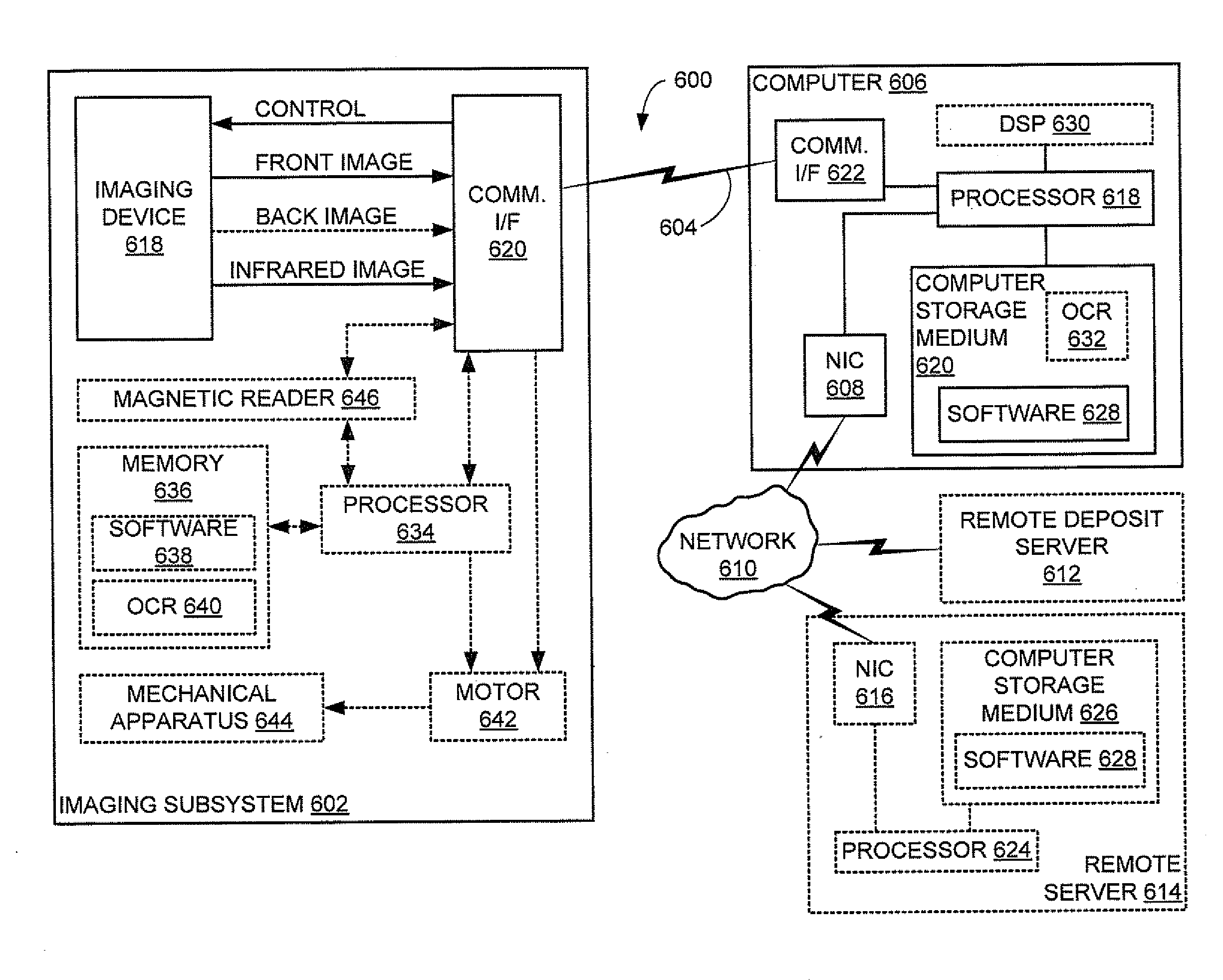

Infrared and Visible Imaging of Documents

ActiveUS20100258629A1Paper-money testing devicesMaterial analysis by optical meansPaymentComputer science

A payment item having a magnetic ink character recognition (MICR)-line on its front is handled by generating, using visible light, a front image of the front of the payment item, generating, using infrared light, an infrared image of the front of the payment item or of a portion of the front of the payment item containing its MICR-line, and performing optical character recognition on the infrared image to identify data encoded in the MICR-line.

Owner:AMBIR TECH

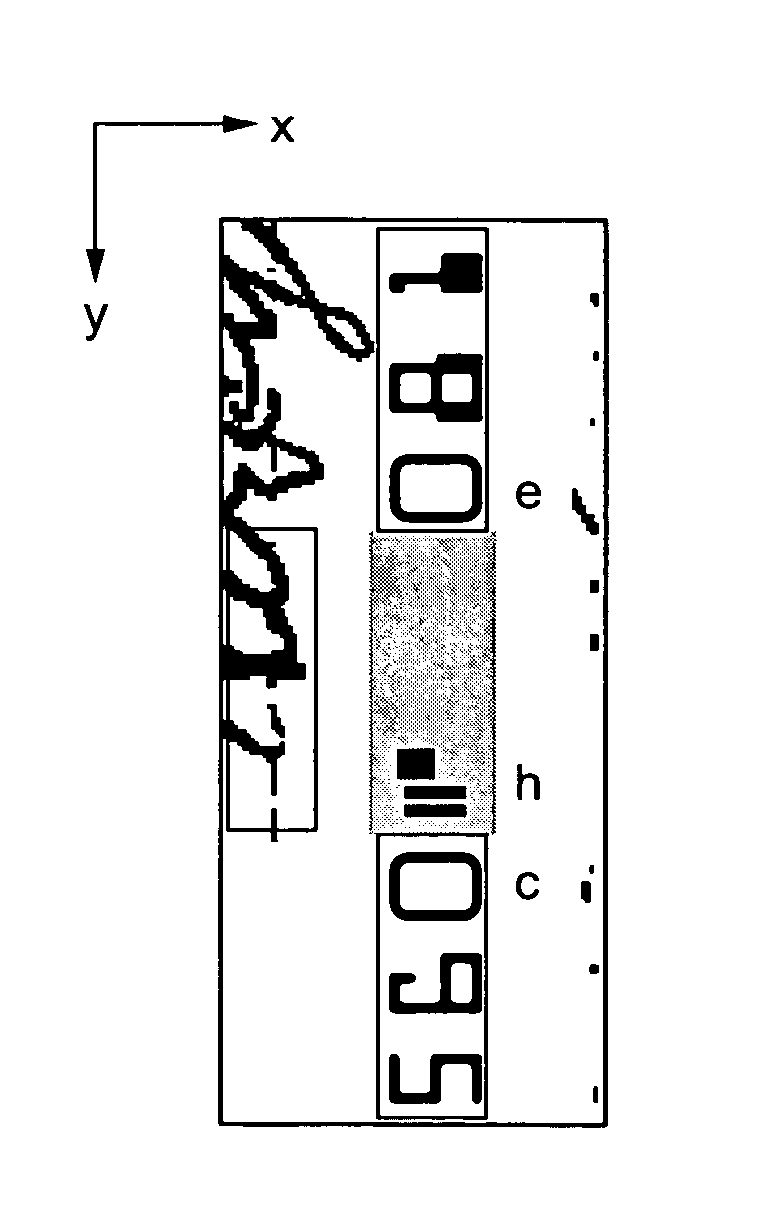

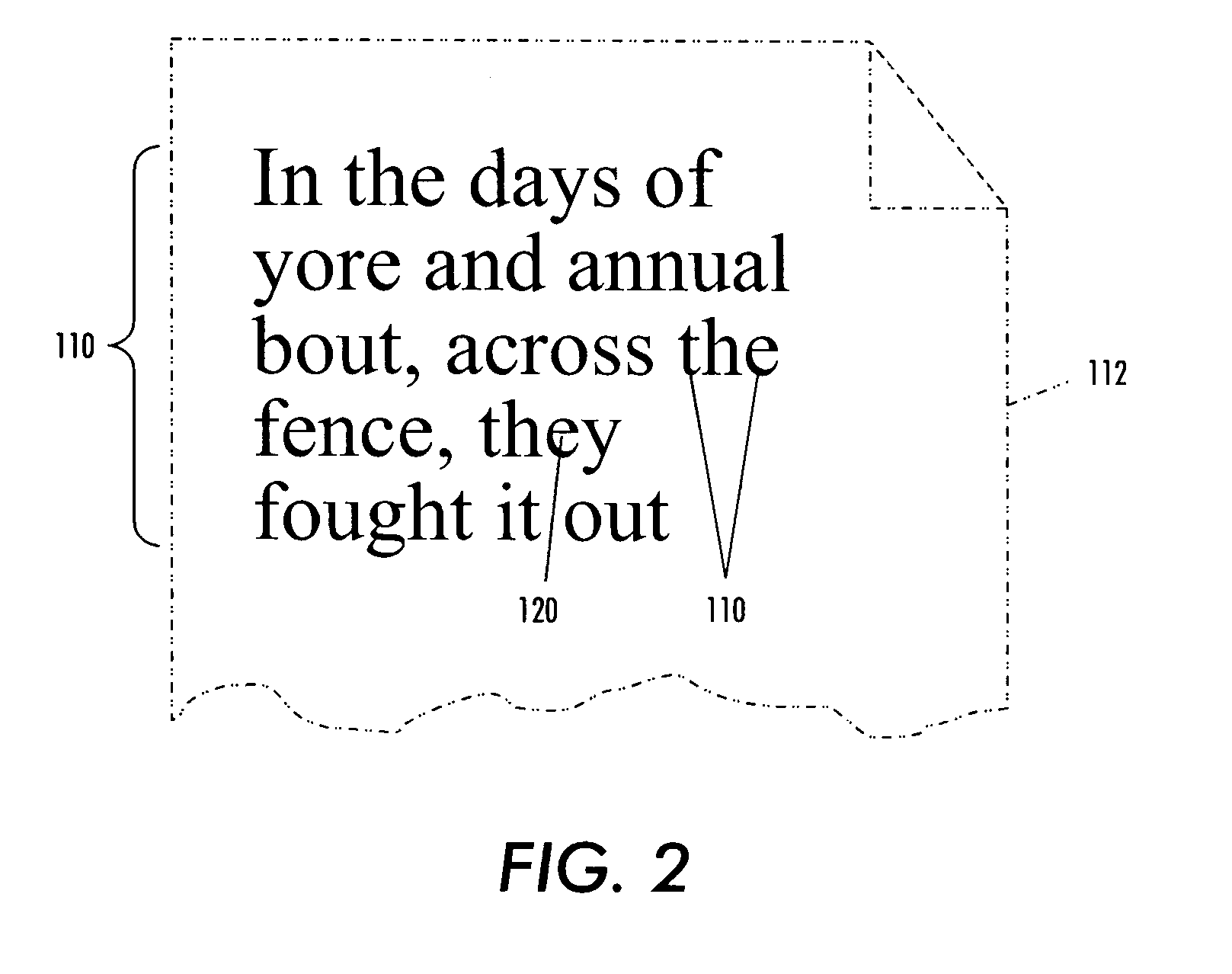

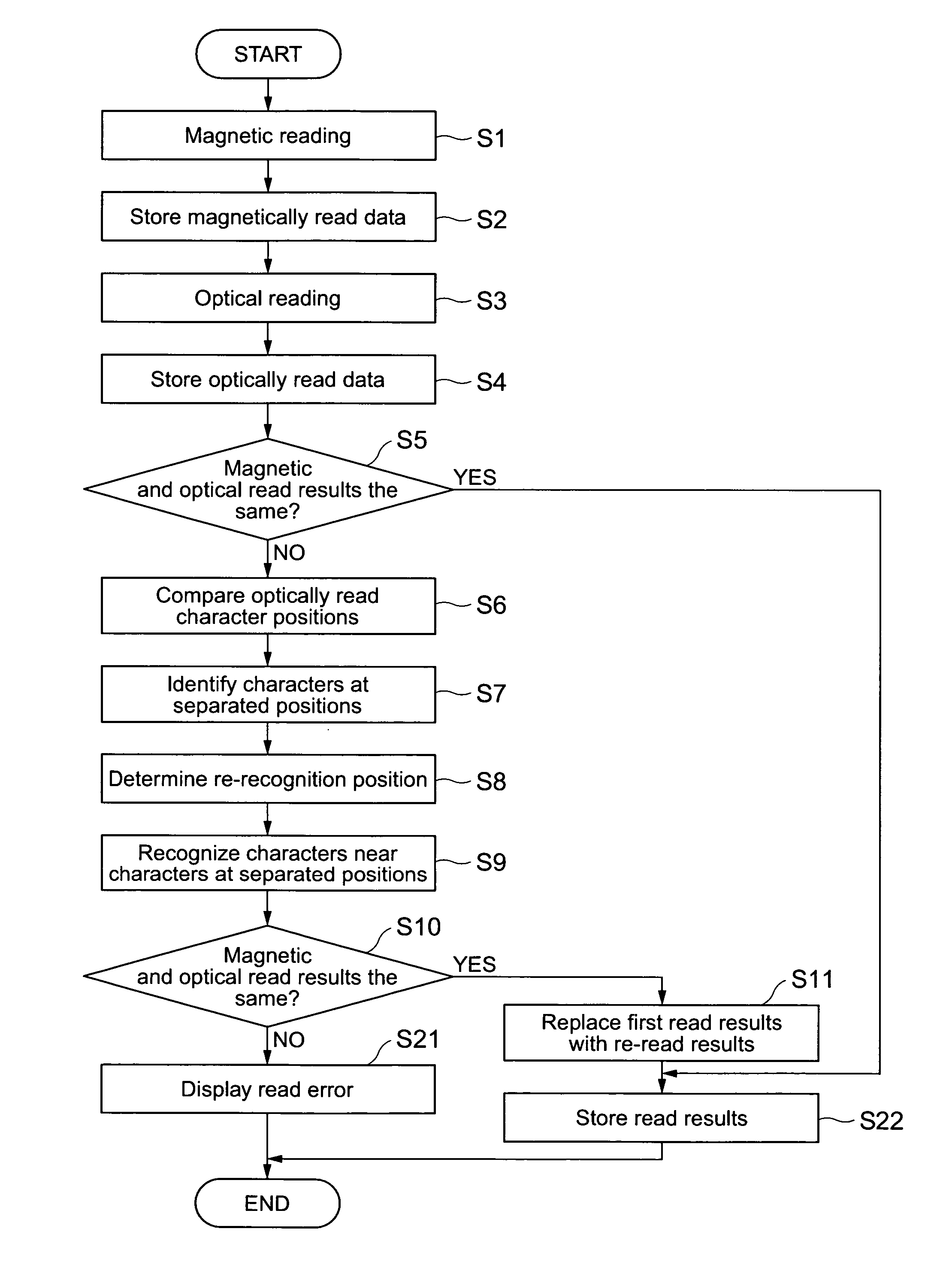

Magnetic ink character recognition apparatus and magnetic ink character recognition method

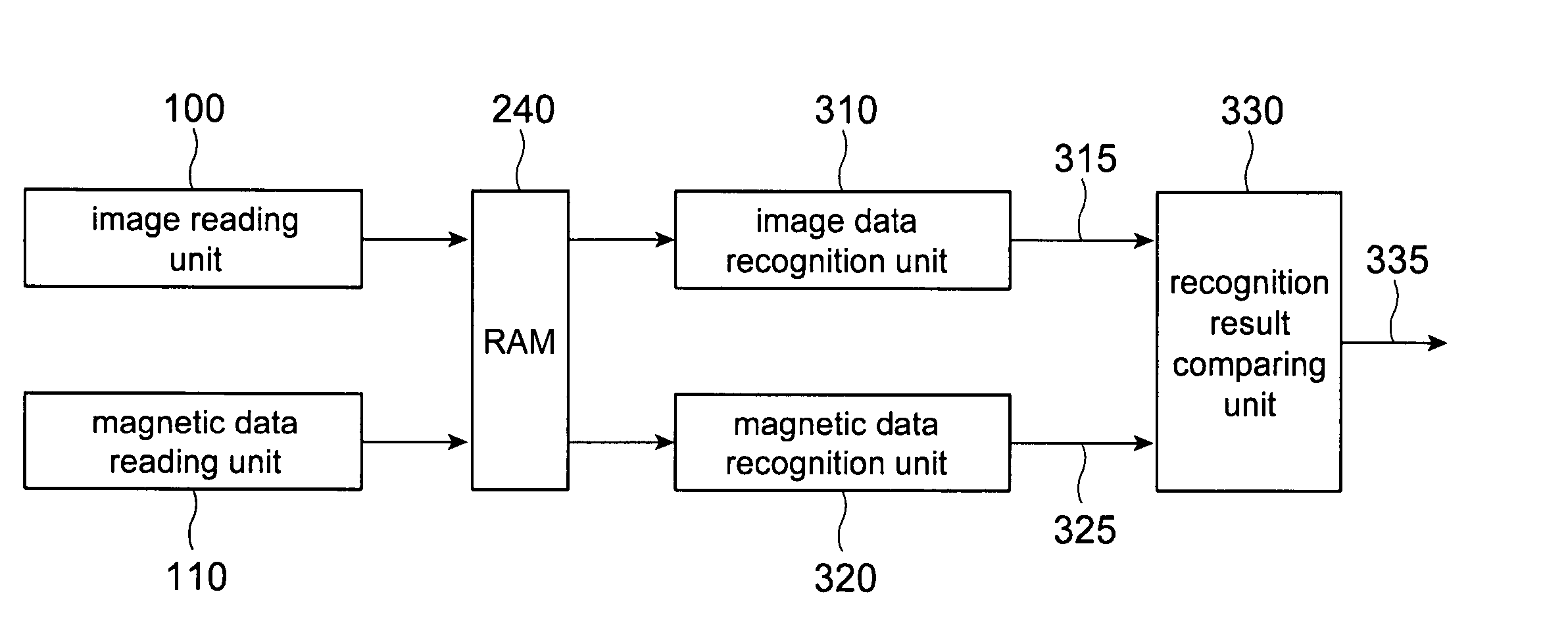

InactiveUS20060088199A1Improves character recognition reliabilityHigh recognition reliabilityCharacter and pattern recognitionPayment architectureIdentification deviceData application

Column misalignment between a character string recognized by a MICR and a character string recognized by optical character recognition is corrected to improve character recognition reliability. A magnetic data reading unit detects the magnetism of a character string printed in magnetic ink and outputs the detected magnetic data. An image reading unit optically reads the same character string printed in magnetic ink and outputs the image data. A magnetic data recognition unit applies a character recognition process to the magnetic data output by the magnetic data reading unit and outputs magnetic data recognition result. An image data recognition unit applies character recognition to the image data output by the image reading unit and outputs image data recognition result. A recognition result comparing unit applies a column offset detection process to detect misalignment between the character columns in the magnetic data recognition result and image data recognition result, then applies a column offset correction process to correct the column offset and align corresponding character columns, and then compares corresponding character columns in the magnetic data recognition result and image data recognition result based on the character strings after correcting the column offset and outputs a final recognition result.

Owner:SEIKO EPSON CORP

Magnetic fluid suitable for high speed and high resolution dot-on-demand inkjet printing and method of making

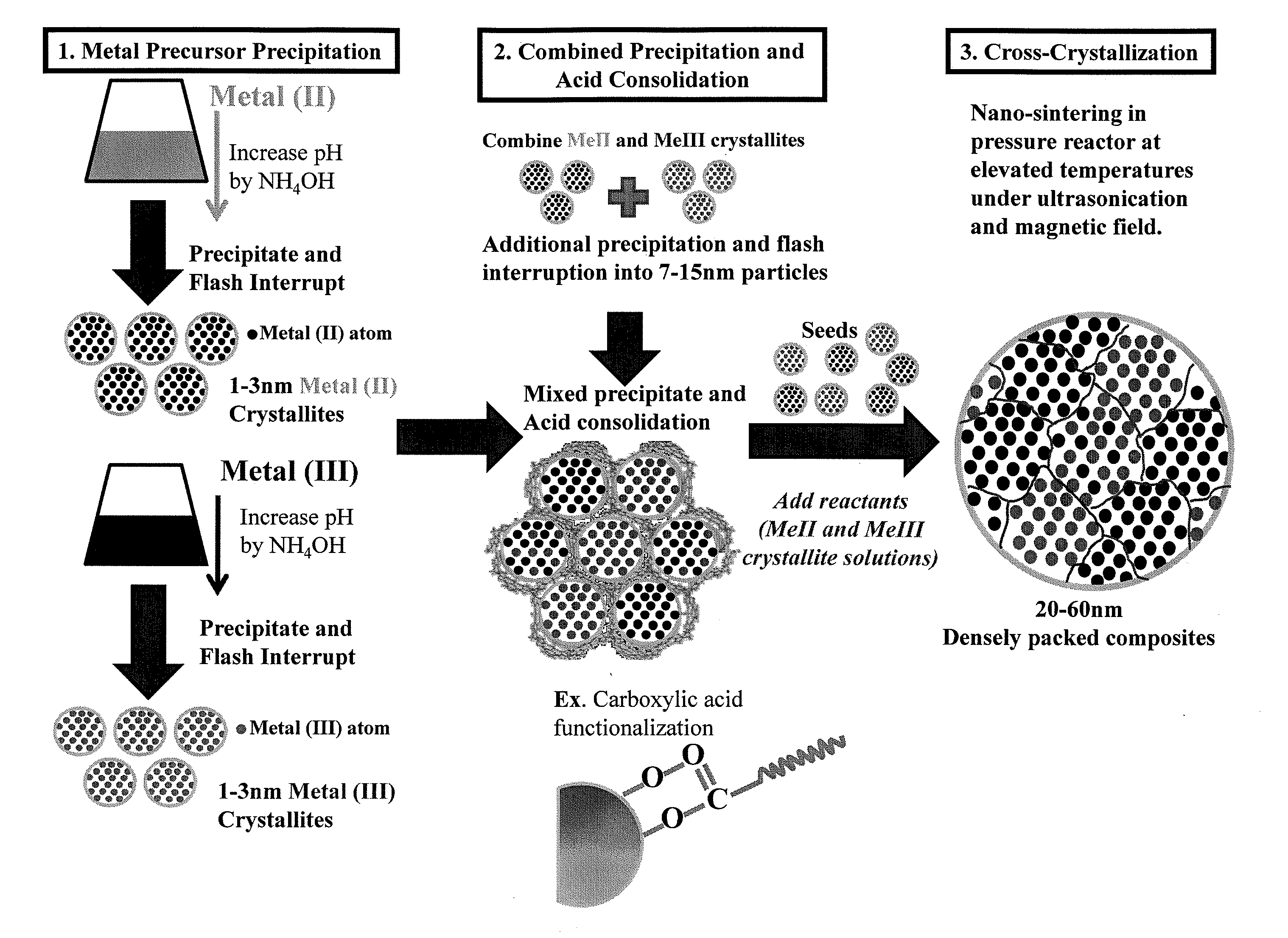

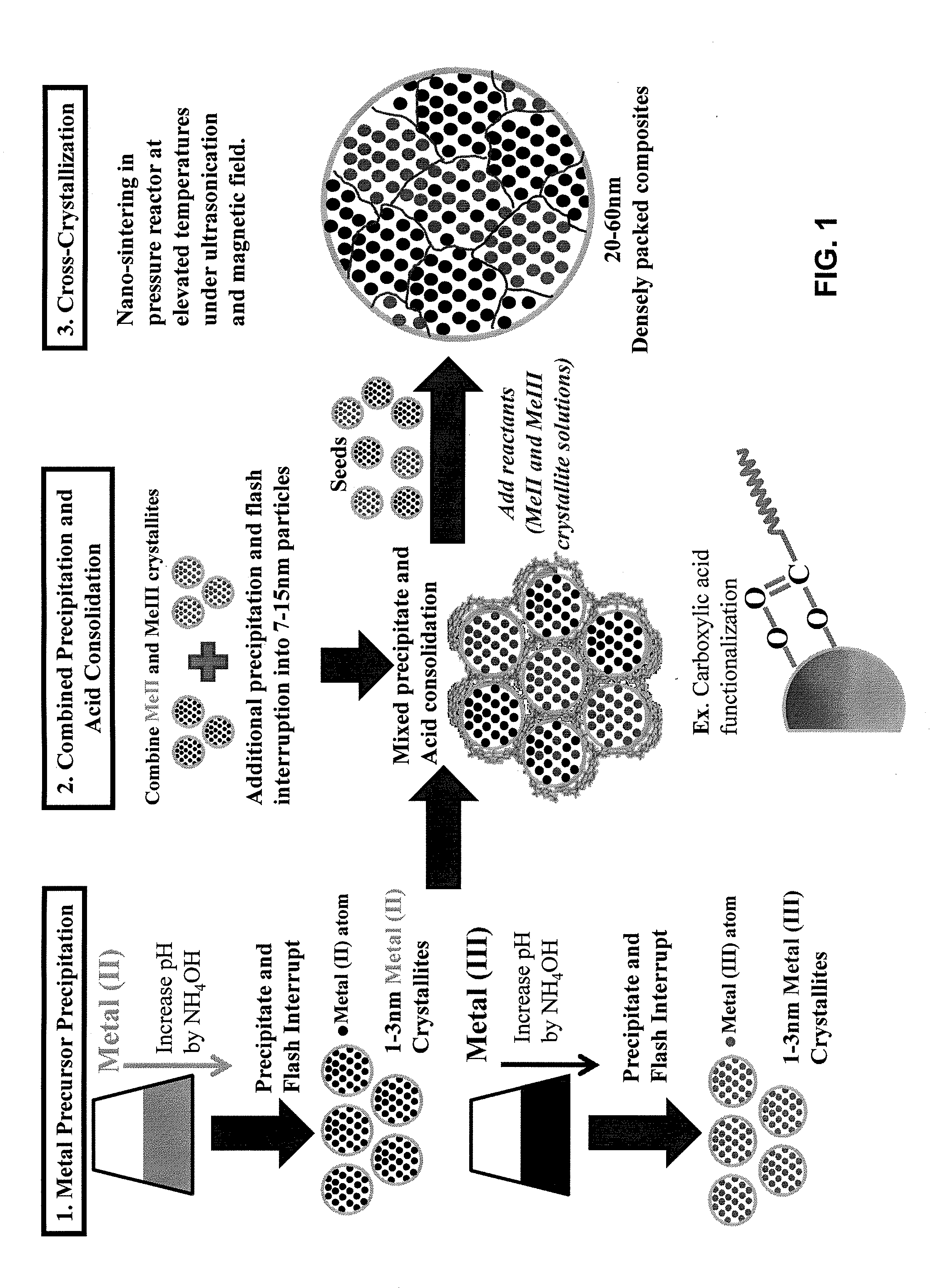

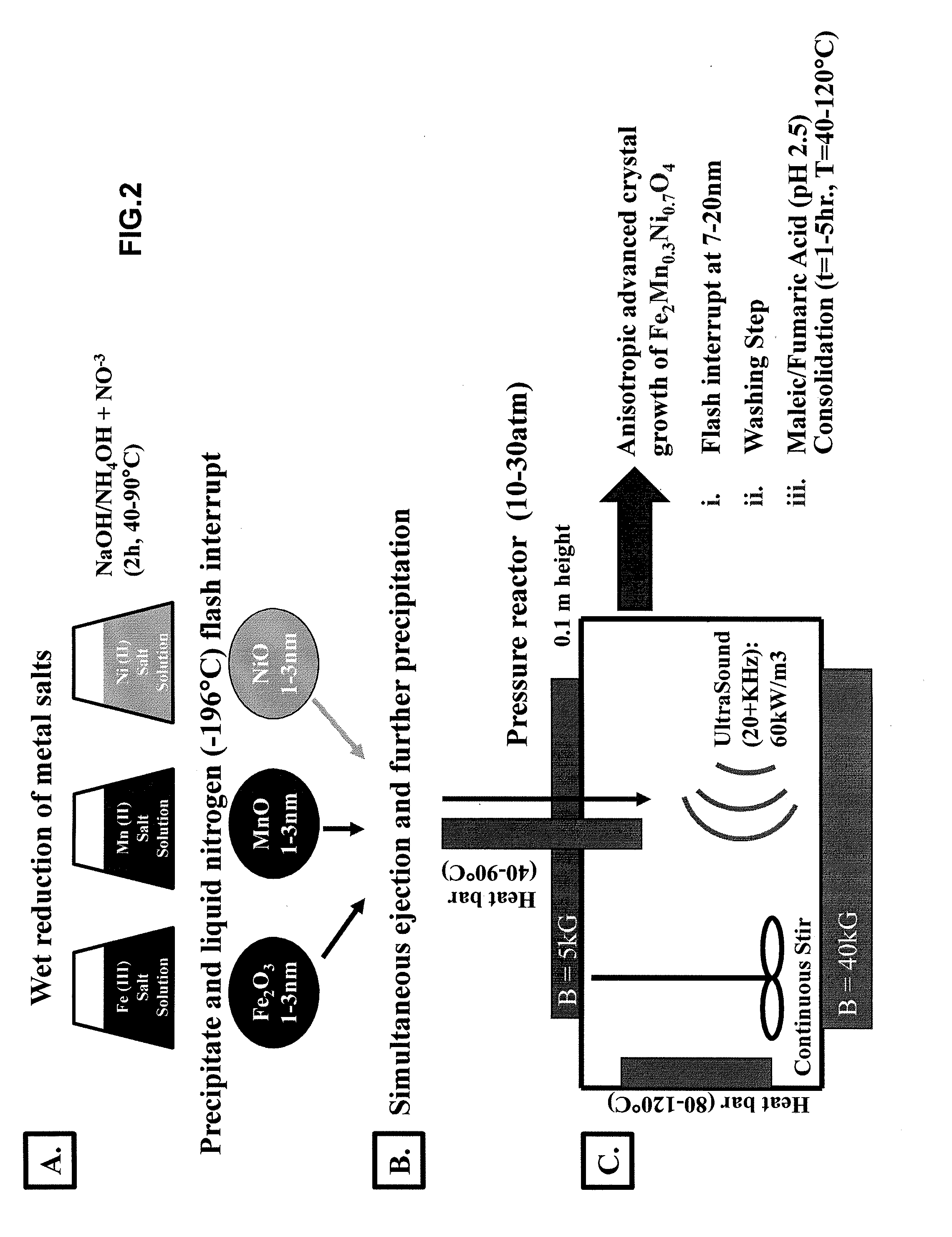

ActiveUS20120225264A1Increase printing speedImproved resolution characteristicCylinder pressesMaterial nanotechnologyRare earthOxidation state

A magnetic fluid composition include a suspension of nano-particles including cross-crystallized multi-metal compounds dispersed in a solvent, the cross-crystallized multi-metal compounds including at least two or more metals having different valencies or oxidation states, the metals selected from the group consisting of a monovalent metal (Me+), a divalent metal (Me2+), a trivalent metal (Me3+), a quadrivalent metal (Me4+) and a rare earth metal. The magnetic fluid having a viscosity and surface tension that permits dispensing from an inkjet printer at a rate of at least 2.5 m / s, at a resolution of at least 600 dpi, supporting jetting pulse frequencies of at least 15 KHz per nozzle (enabling high speed inkjet printing applications of at least 0.6 m / sec per individual nozzle row per print head), and enabling uninterrupted, industrial level print output of magnetic ink character recognition (MICR) code lines suitable for high speed magnetic data scanning per established industry regulations (ANSI X9).

Owner:VILLWOCK THOMAS

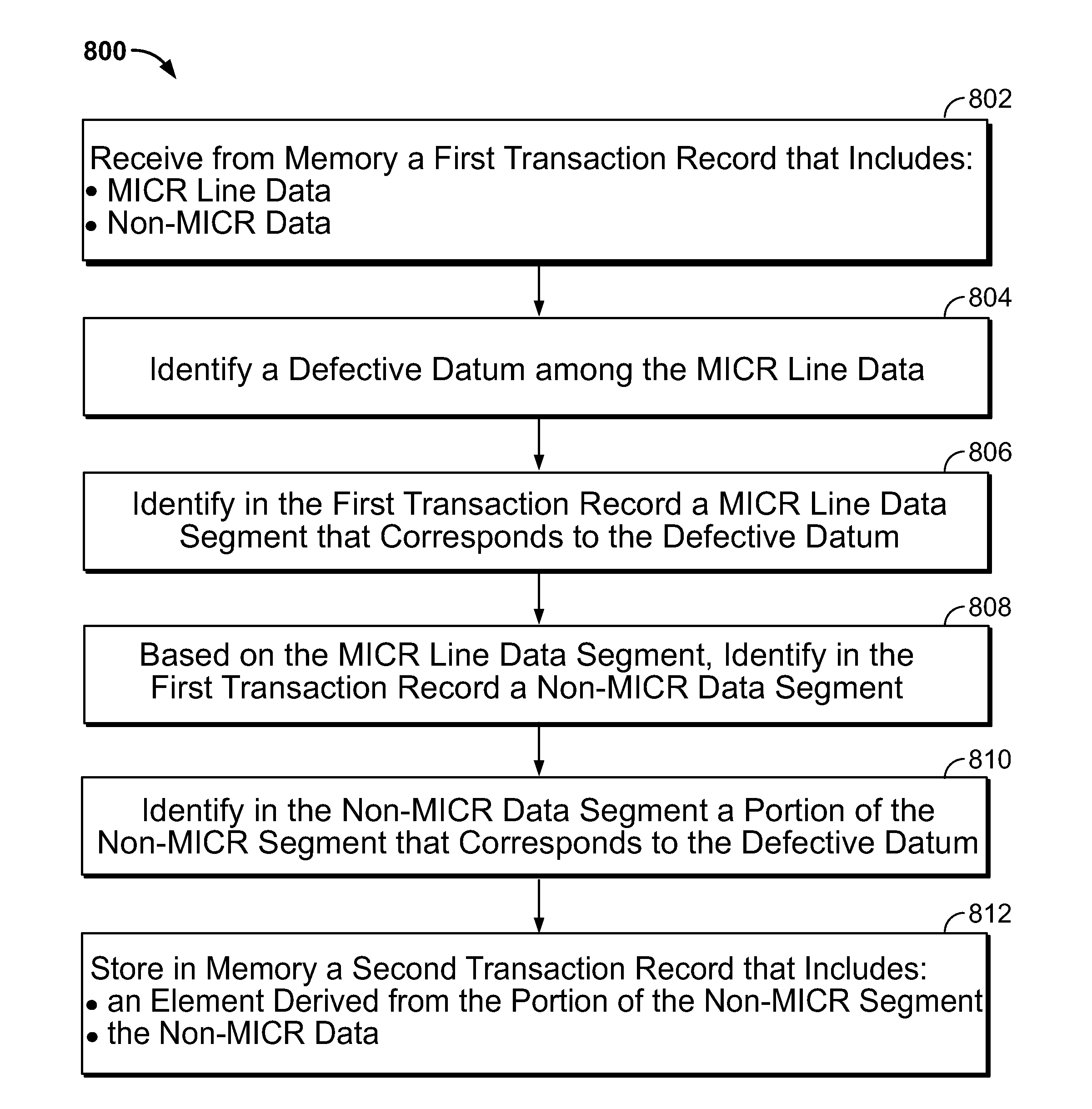

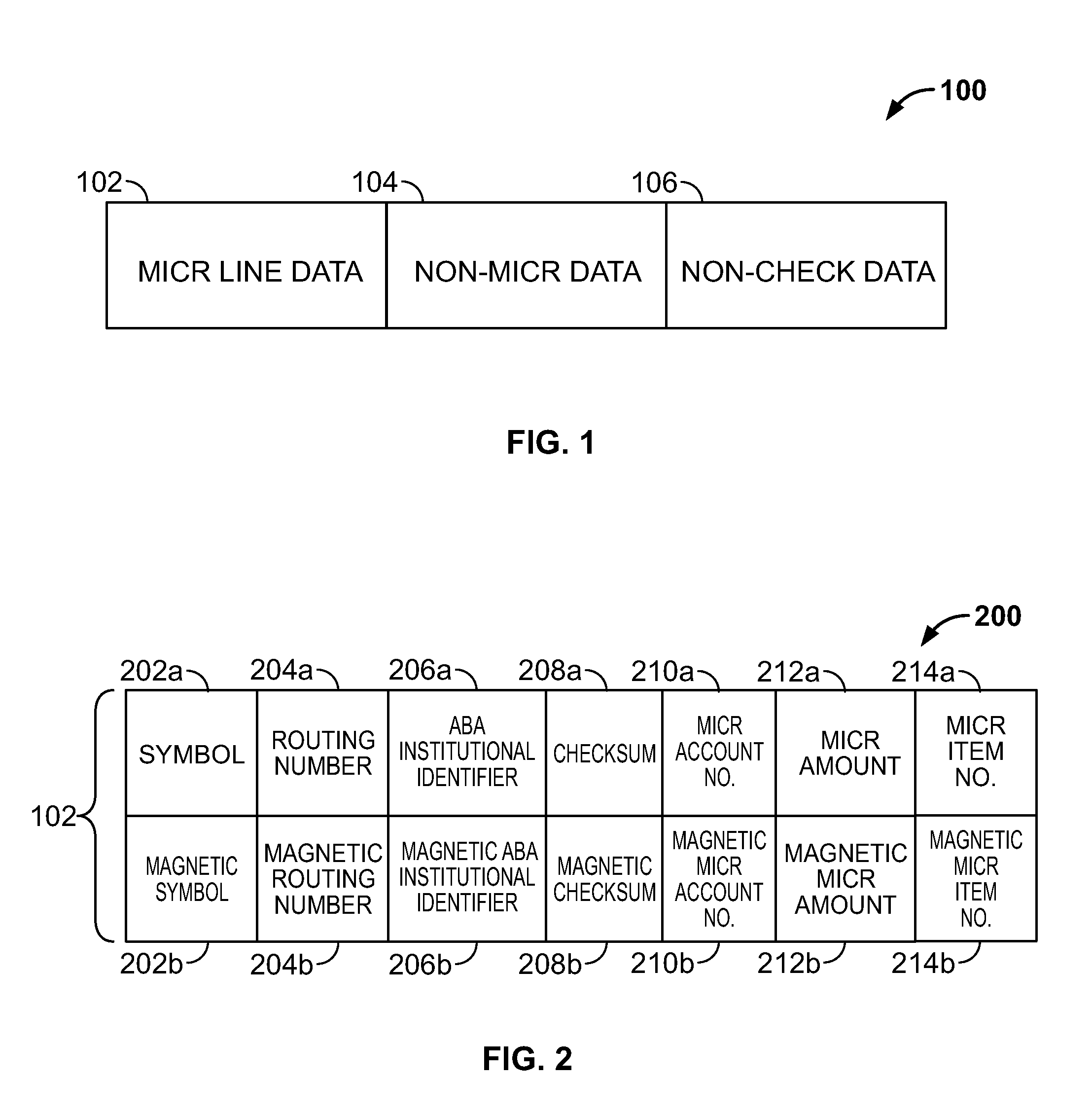

Correction of check processing defects

ActiveUS20140052697A1Reduce needDigital data information retrievalDigital data processing detailsChequeOperating system

Owner:BANK OF AMERICA CORP

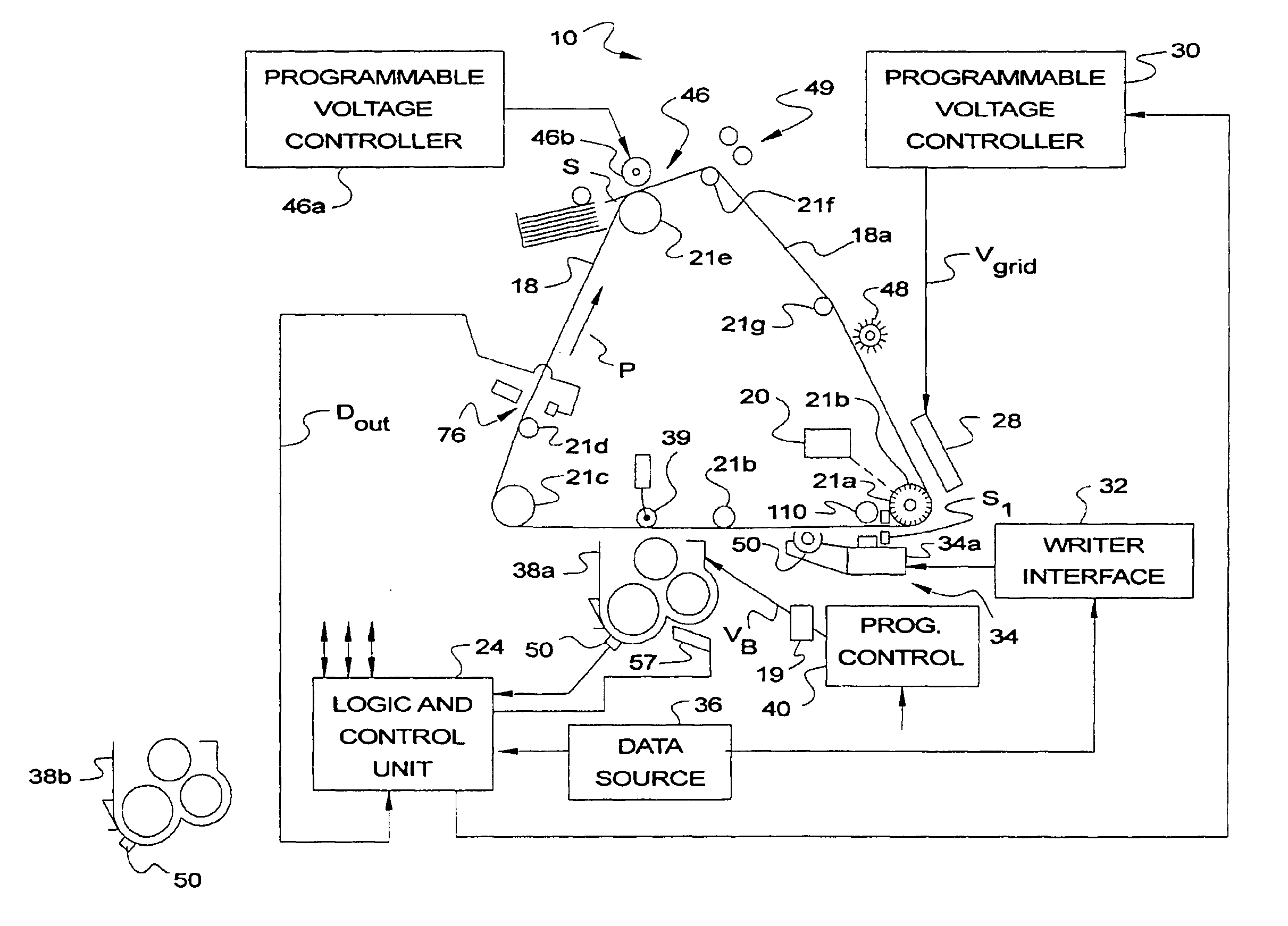

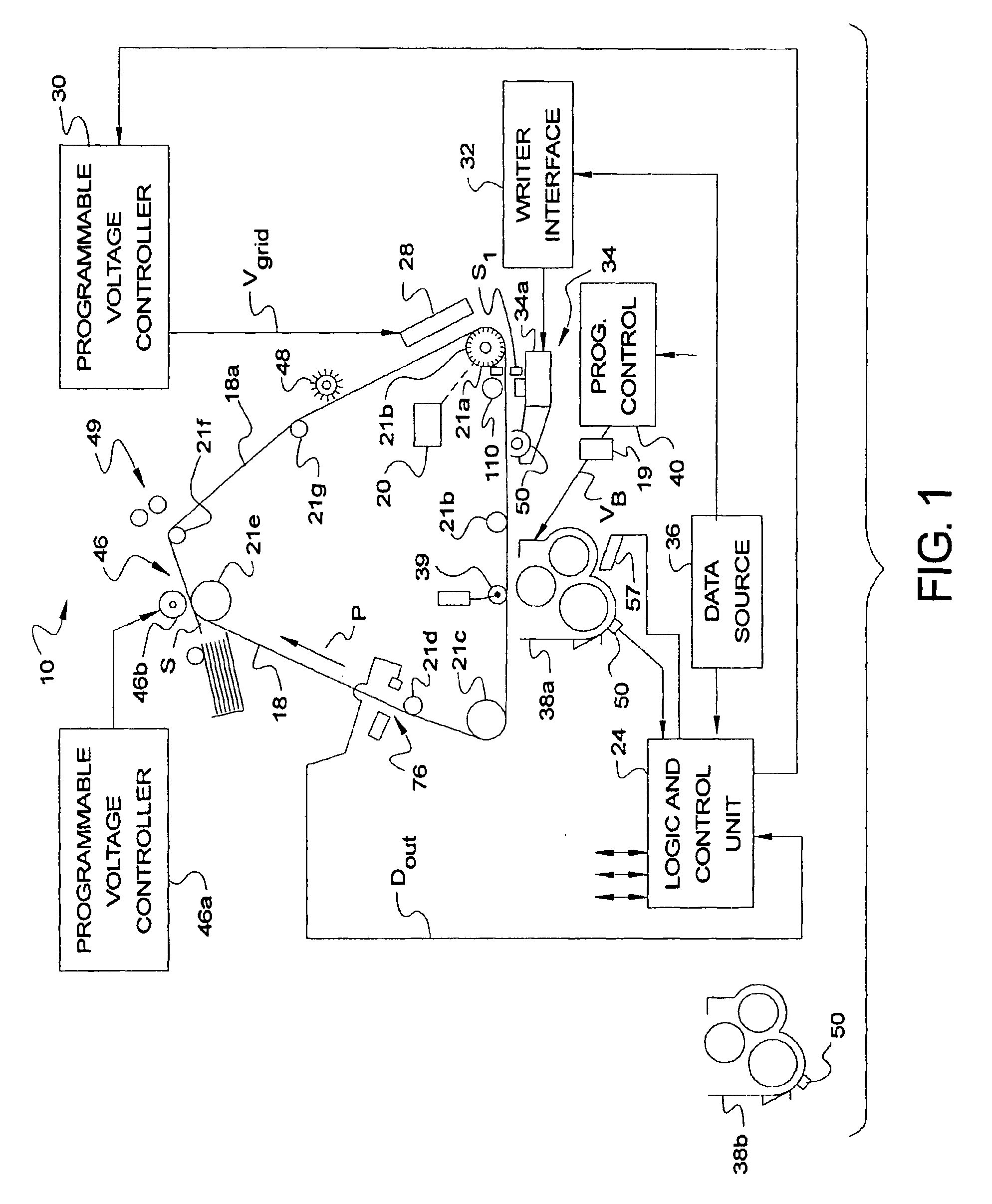

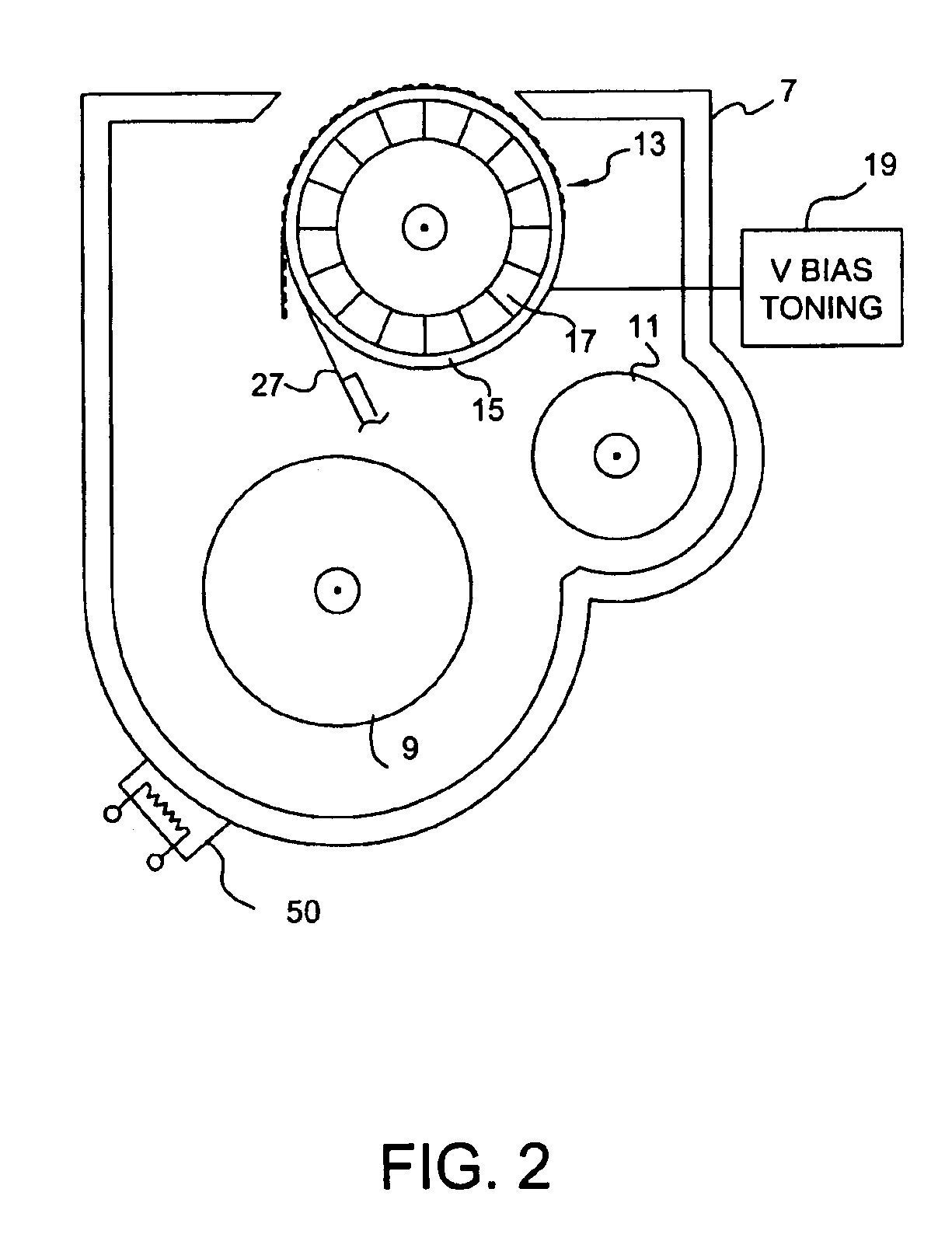

Functionality switching for MICR printing

An electrographic printing machine (10) operable in combination with an installed one of a plurality of developing, or toning, stations (38a, 38b), is disclosed. Each of the plurality of toning stations (38a, 38b) is associated with a toner type, with one of the toning stations (38a) associated with Magnetic Ink Character Recognition (MICR) toner. Each toning station (38a, 38b) has an indicator (50), for example a resistor, that can be interrogated or measured by the printing machine (10) when installed, so that the printing machine (10) is aware of the type of toner to be used. If a MICR toning station (38a) is installed, a set of process setpoints and parameters are used that optimize MICR printing; if a normal toning station (38b) is installed, a different set of process setpoints and parameters adapted for the normal toner is used. Also in response to detecting that the MICR toning station (38a) is installed, the printing machine (10) enables certain security functions, such as privilege-level control of MICR fonts and secure files, and also such as disabling features such as automatic reprinting.

Owner:HEIDELBERG DIGITAL +1

System and method for detecting cheque fraud

Owner:ELECTRONICS IMAGING SYST CORP

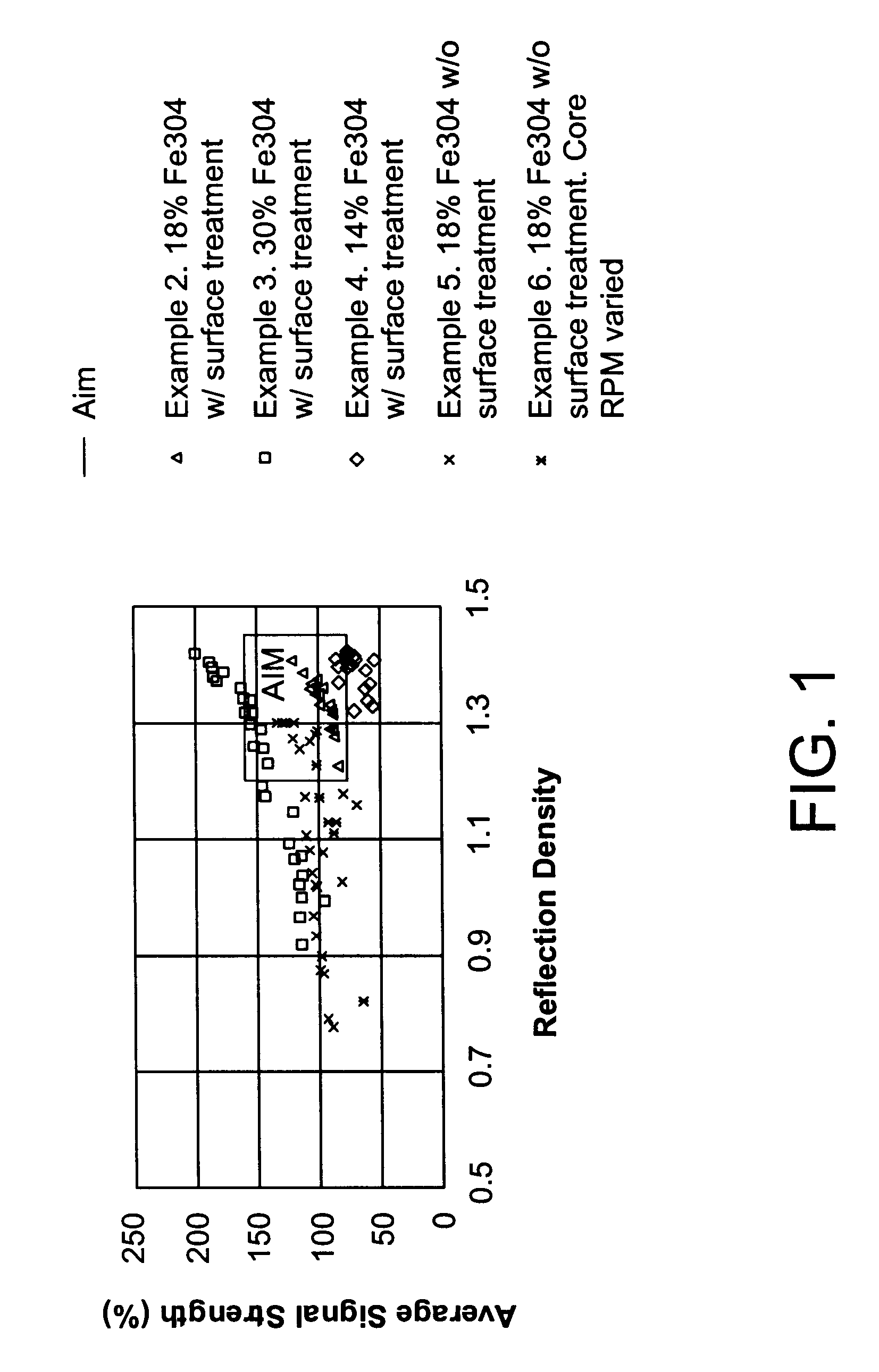

Development systems for magnetic toners having reduced magnetic loadings

InactiveUS6610451B2Image quality is clearReduce the amount requiredNanosensorsElectrographic process apparatusEngineeringNon magnetic

Development systems and methods for developing using magnetic toner are disclosed. The present invention further discloses developers used in development systems as well as the toner used in developer for magnetic ink character recognition printing. With respect to the development system, a development system is disclosed which includes a supply of dry developer mixture which contains magnetic toner particles and hard magnetic carrier particles. The development system further includes a non-magnetic, cylindrical shell for transporting the developer between the supply and the development zone, wherein the shell can be rotatable or stationary. A rotating magnetic core of a pre-selected magnetic field strength and means for rotating at least the magnetic core to provide for the transport of the toner particles from the shell to an electrostatic image also provided as part of the development system. A method for developing electrostatic image with magnetic toner is further disclosed, for example, involving the above-described development system. Magnetic toner particles having a low magnetic loading such as on the order of 28% by weight or less, based on the weight of the toner are further described wherein these magnetic toners can include a spacing agent on the surface of the magnetic toner particles. A developer is further disclosed which contains the magnetic toner particles of the present invention with hard magnetic carrier particles. Other developer compositions are also described.

Owner:COMML COPY INNOVATIONS INC +1

Magnetic toner and conductive developer compositions

Magnetic toner compositions, conductive developer compositions, and methods for producing images in a hybrid jumping development system, more specifically, in a magnetic ink character recognition system, are disclosed. The developer compositions contain coated magnetic toner particles and coated carrier particles. The toner compositions include a resin, colorant, wax, magnetic component, and surface additives of coated silica, titania, and zinc stearate.

Owner:XEROX CORP

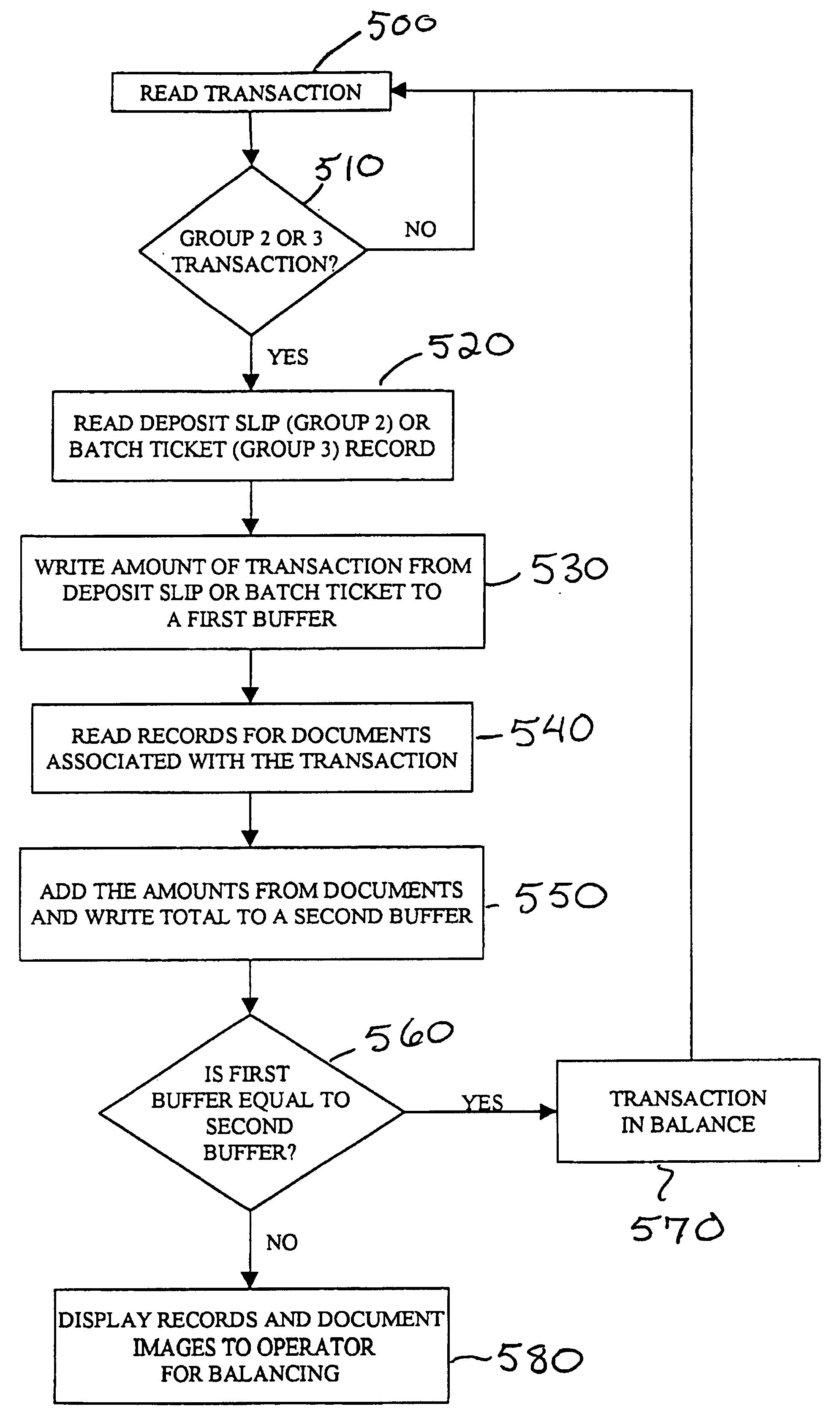

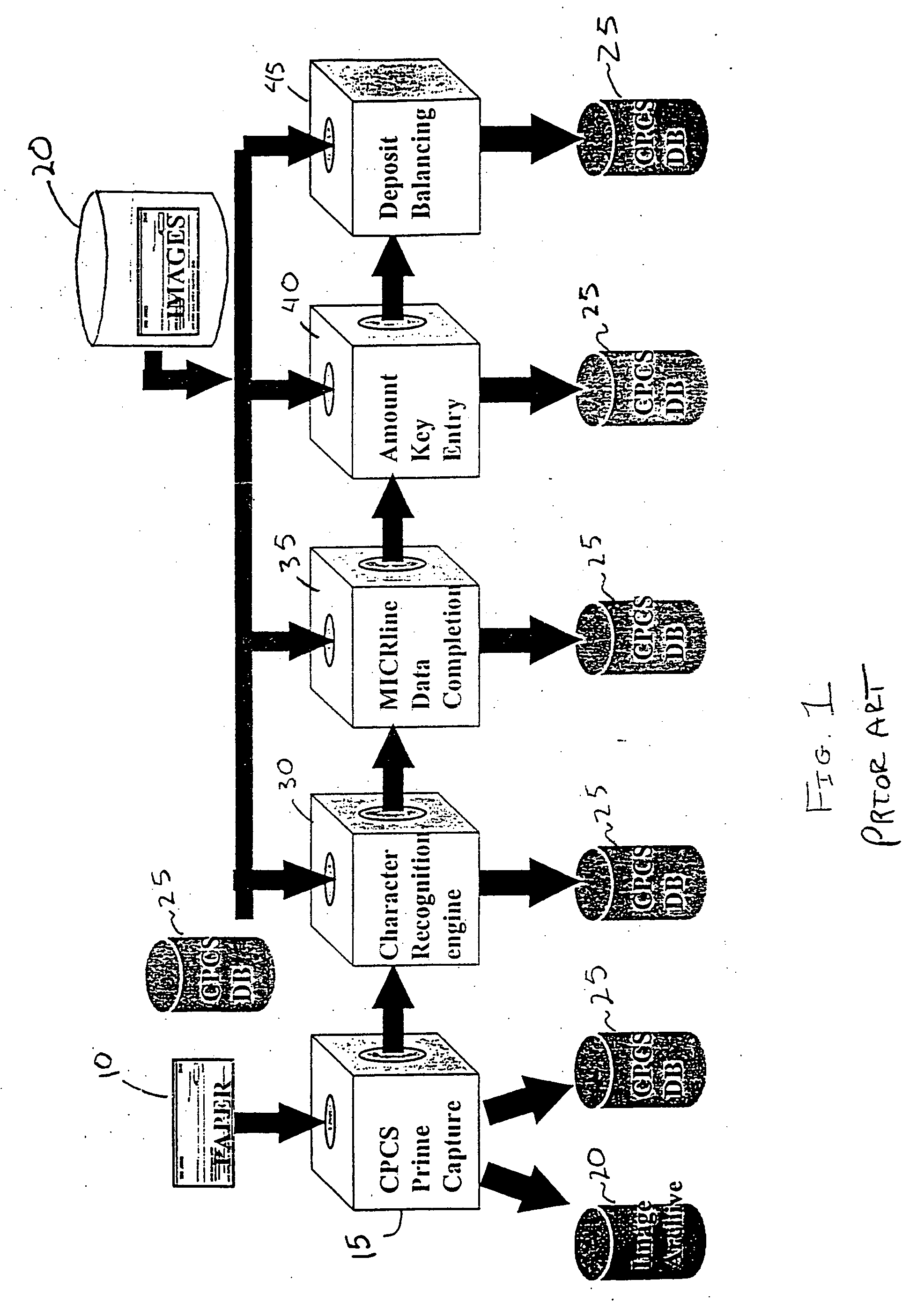

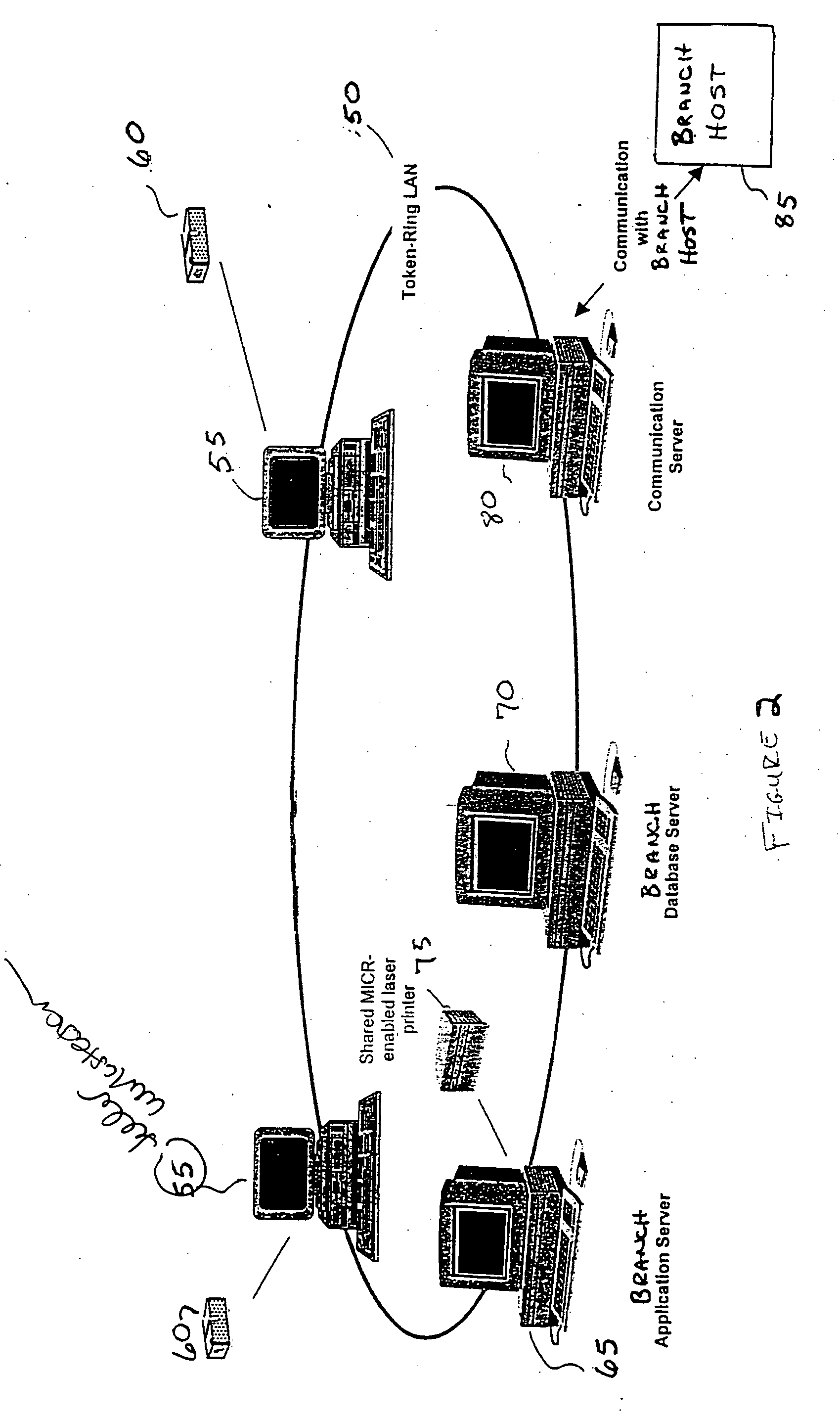

System and method for back office processing of banking transactions using electronic files

InactiveUS20060080255A1Reduce equipmentReduce laborComplete banking machinesFinanceBank tellerRelevant information

As banking transactions are processed by a bank teller, all of the relevant information with respect to the transaction (e.g., dollar amount) is captured in an electronic file. Each of the electronic files from the various branches of the bank are forwarded to a central back office processing center where the electronic files are combined into a single Transaction Repository. At the end of the branch day, all of the paper associated with the transactions is forwarded from the branches to the back office processing center. The paper transactions are imaged in the conventional manner and the Magnetic Ink Character Recognition (MICR) data is read from the paper. The present invention then automatically correlates the images and MICR data captured from the paper with the complete transaction record contained in the Transaction Repository. Most of the conventional back office processing can now be performed without the need to perform character recognition and without the need for excess human intervention.

Owner:JPMORGAN CHASE BANK NA

Magnetic ink character reading method and program

InactiveUS7606408B2Suppress misidentificationImprove read rateComplete banking machinesVoting apparatusText stringIdentification error

A magnetic ink character reading apparatus, magnetic ink character reading method and program, and a POS terminal apparatus reduce recognition errors and thereby improve the read rate. The magnetic ink character reading apparatus reads a text string of magnetic ink characters using both a magnetic reading mechanism and optical reading mechanism to obtain magnetic ink character recognition (MICR) results and optical character recognition (OCR) results, which are compared. The OCR process is repeated if the results differ. The positions of the read character blocks are compared to find character blocks that are offset perpendicularly to the base line of the magnetic ink characters, and the OCR process is repeated. The area to which the OCR process is applied again is near the position of the offset character block corrected in the direction perpendicular to the line of magnetic ink characters to be in line with the character blocks for which the MICR result and OCR result were the same.

Owner:SEIKO EPSON CORP

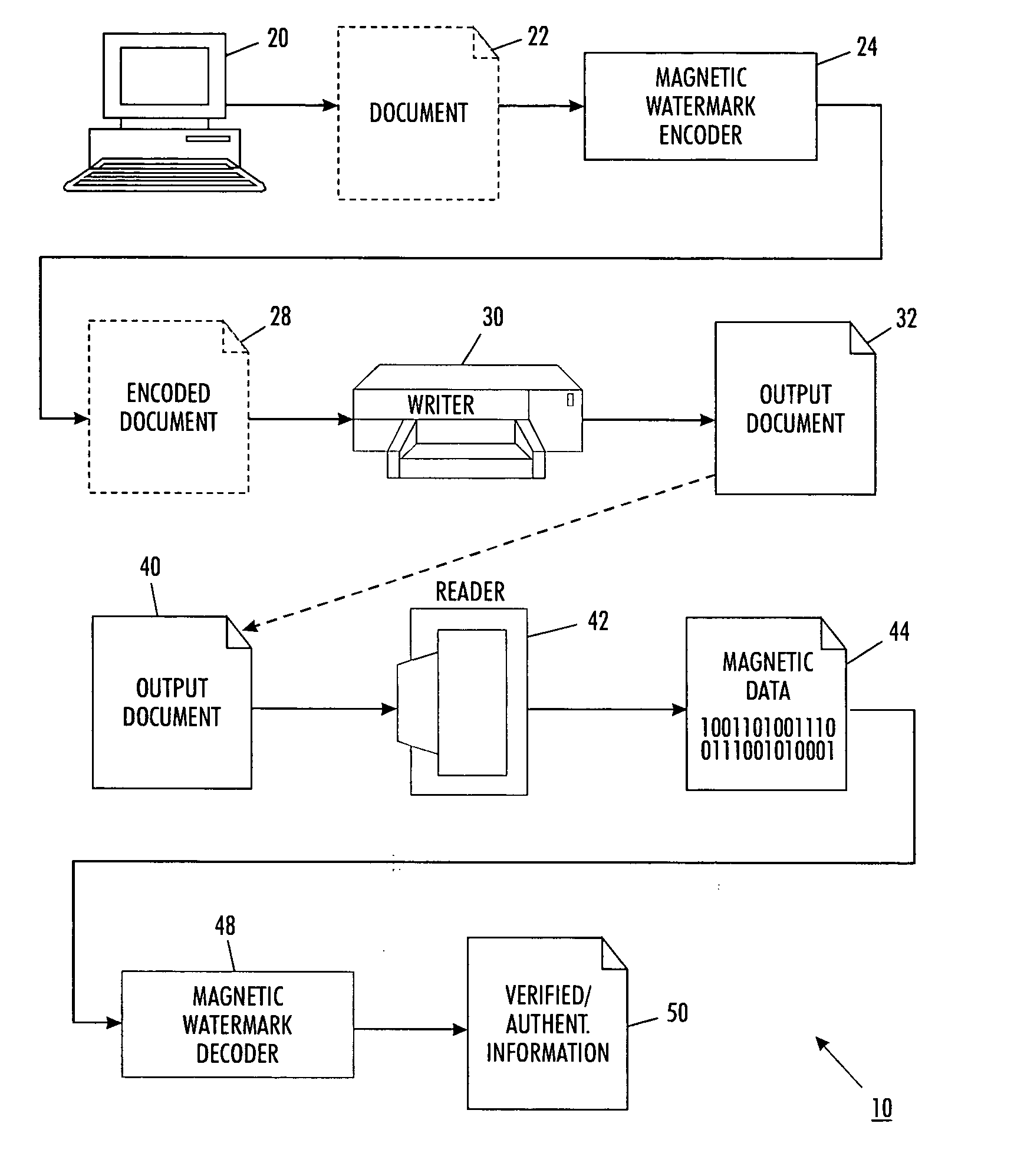

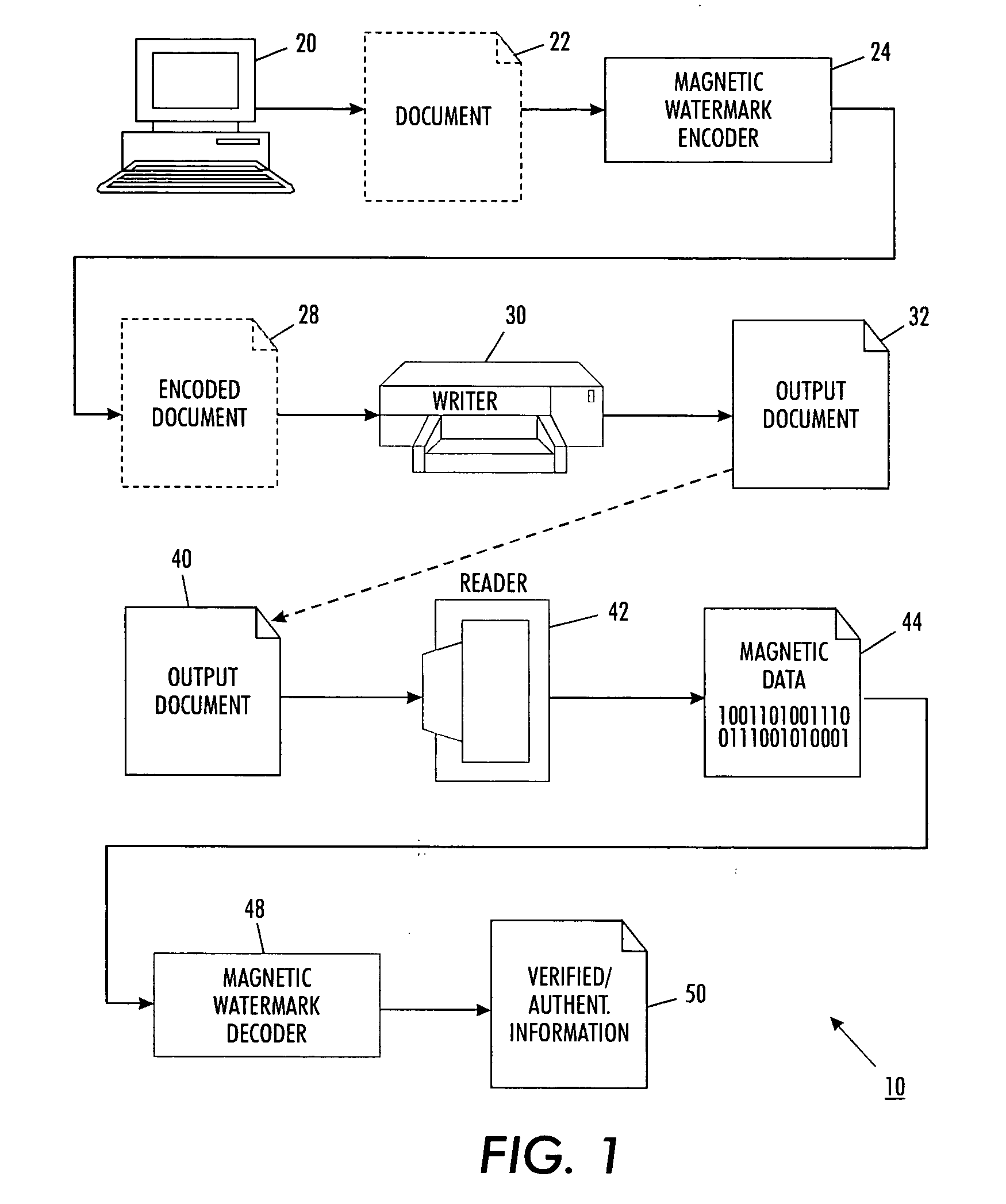

Magnetic watermark for text documents

The present invention is a method and apparatus for applying magnetic ink character recognition (MICR) technology to enable the embedding of coded information within text characters of a document.

Owner:XEROX CORP

Magnetic ink character reading method and program

InactiveUS20050281449A1Suppress misidentificationImprove read rateCharacter and pattern recognitionPayment architectureTerminal equipmentText string

A magnetic ink character reading apparatus, magnetic ink character reading method and program, and a POS terminal apparatus reduce recognition errors and thereby improve the read rate. The magnetic ink character reading apparatus reads a text string of magnetic ink characters using both a magnetic reading mechanism and optical reading mechanism to obtain magnetic ink character recognition (MICR) results and optical character recognition (OCR) results, which are compared. The OCR process is repeated if the results differ. The positions of the read character blocks are compared to find character blocks that are offset perpendicularly to the base line of the magnetic ink characters, and the OCR process is repeated. The area to which the OCR process is applied again is near the position of the offset character block corrected in the direction perpendicular to the line of magnetic ink characters to be in line with the character blocks for which the MICR result and OCR result were the same.

Owner:SEIKO EPSON CORP

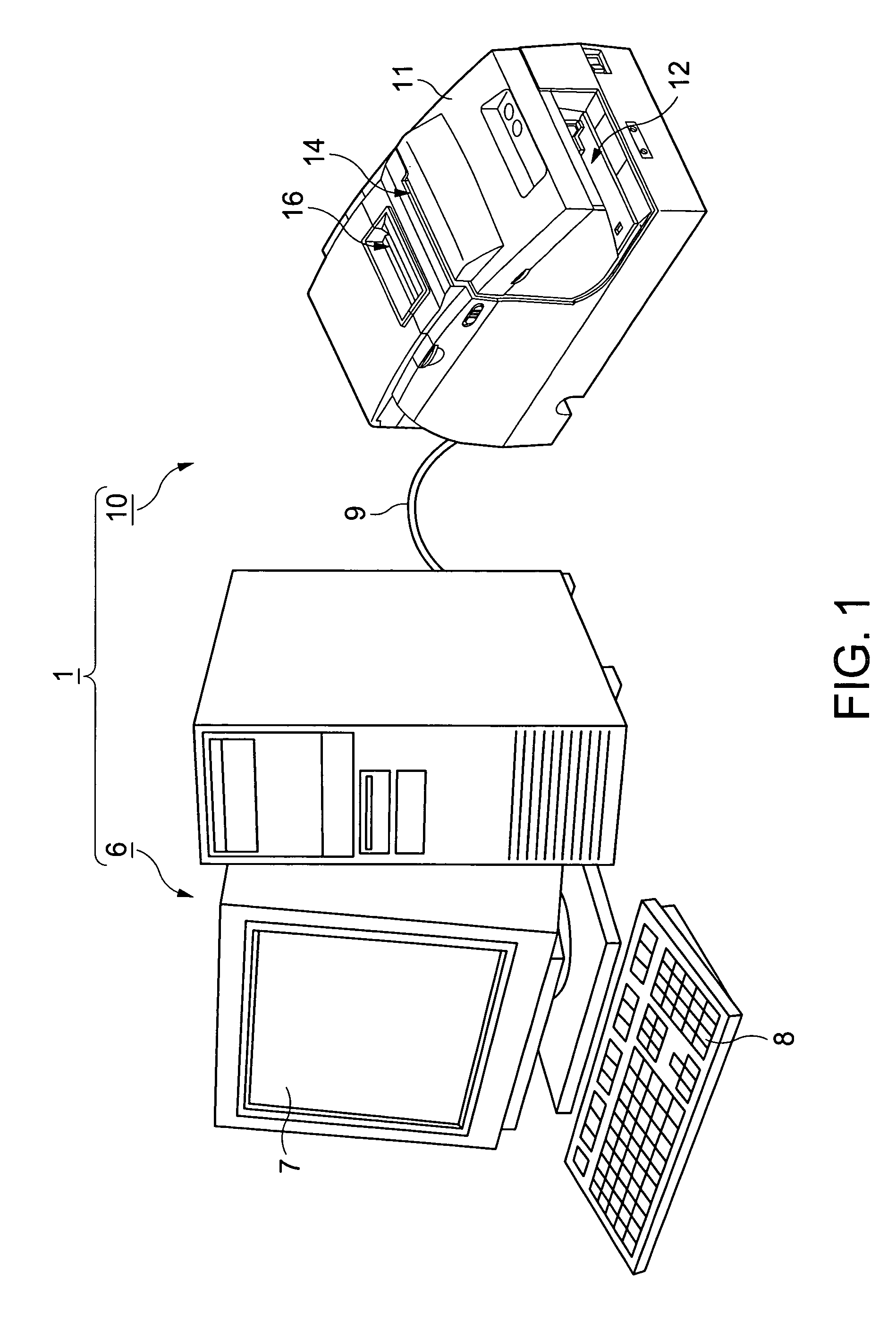

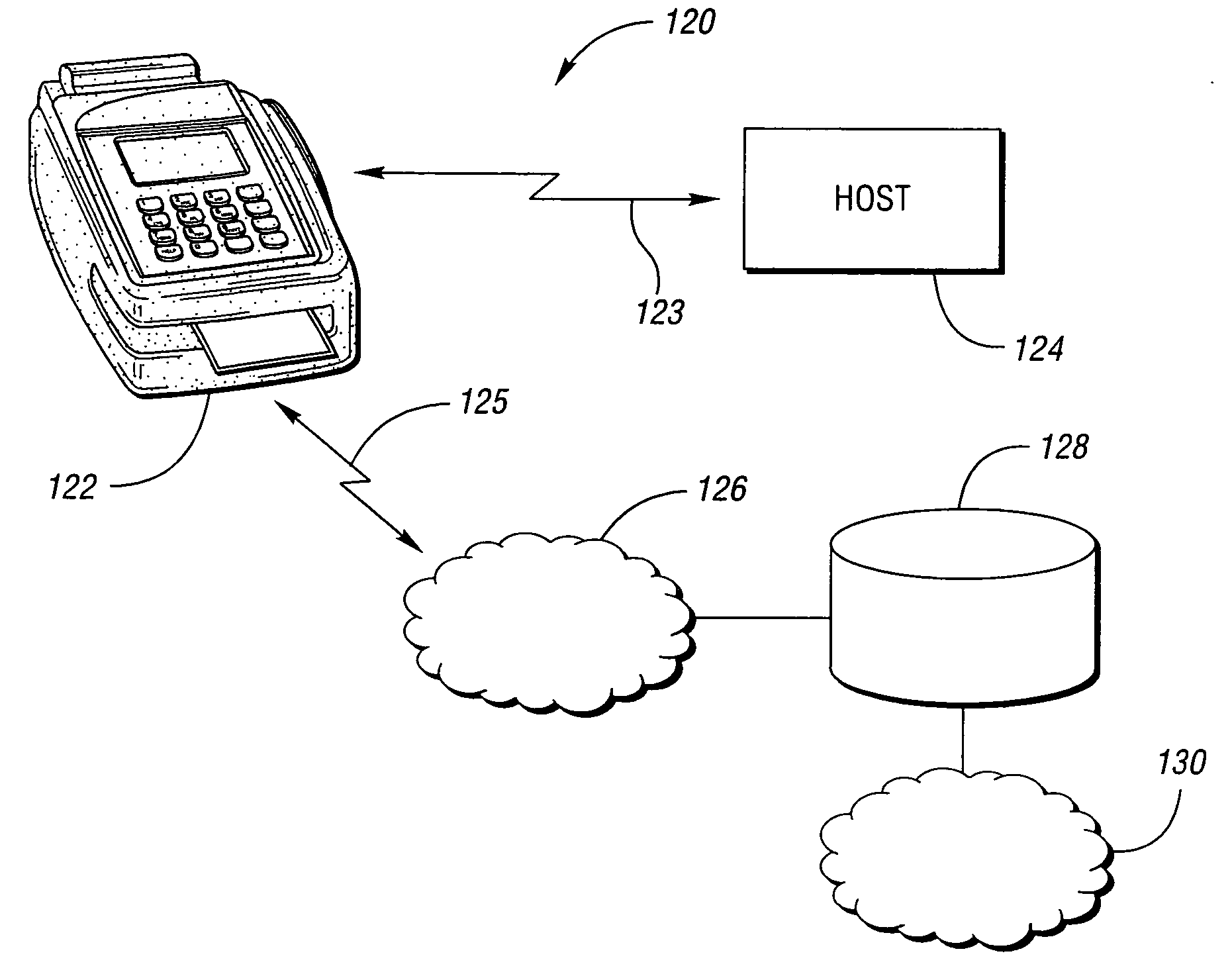

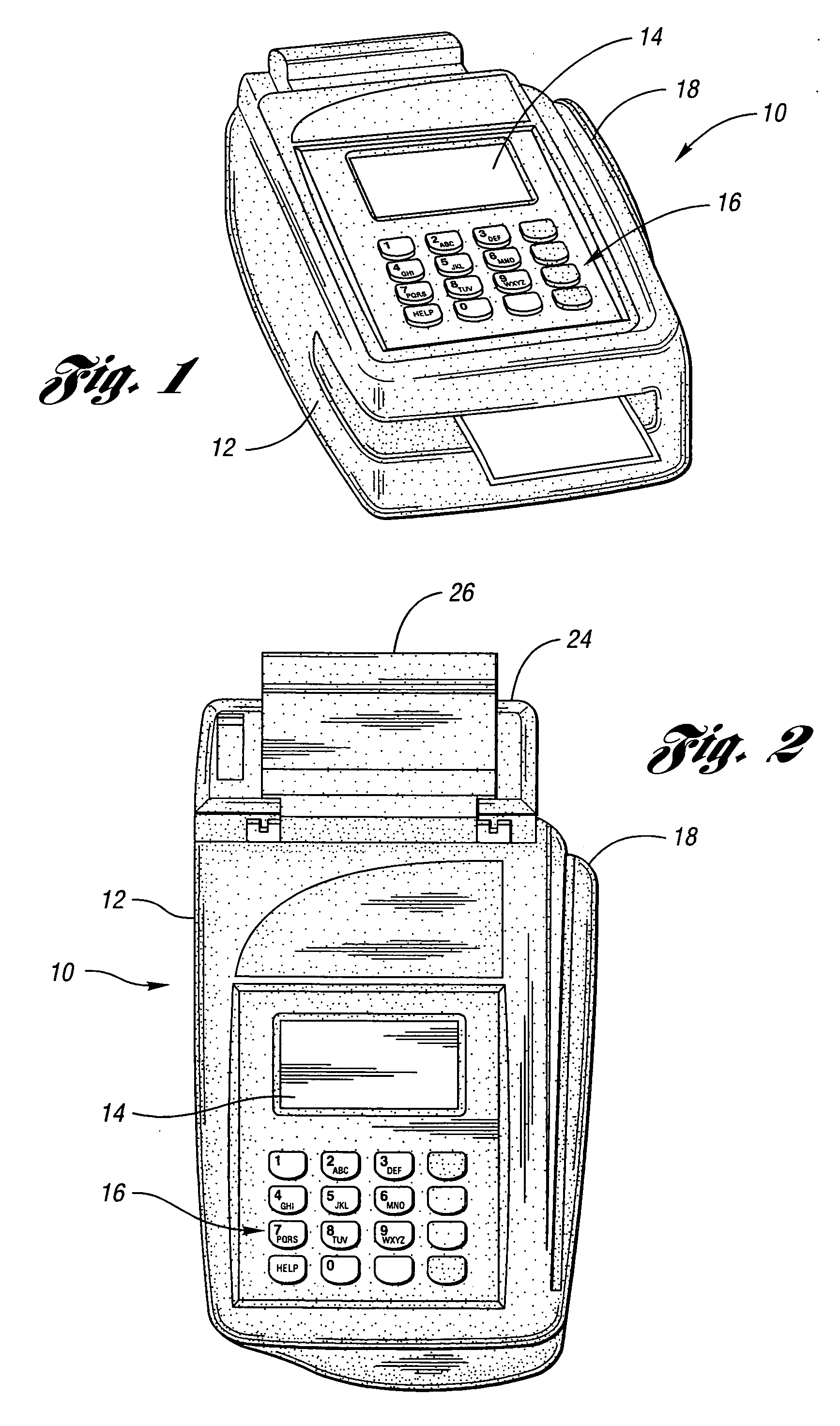

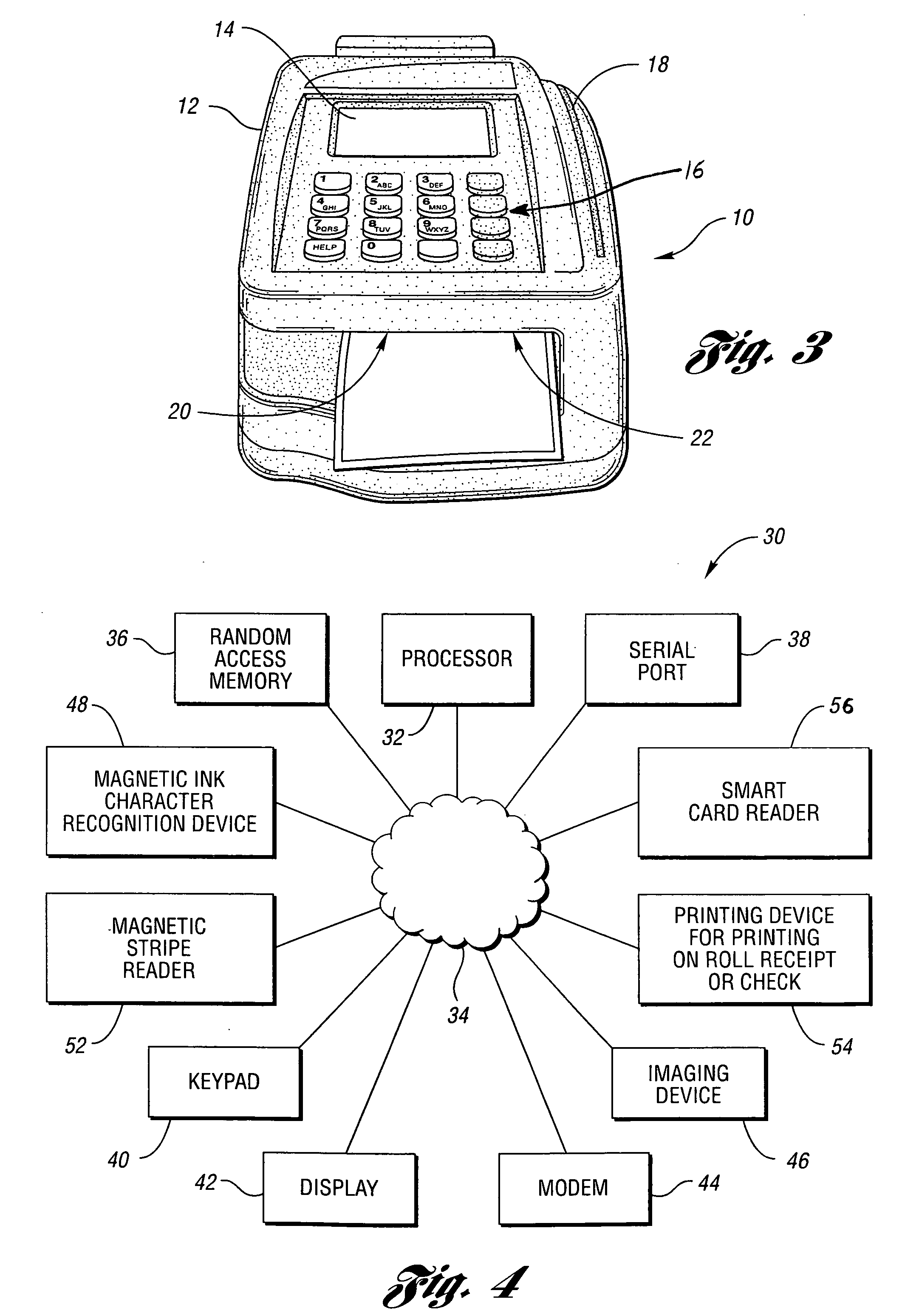

Point of sale payment terminal

InactiveUS20060261155A1Avoid overuseHousing compactComplete banking machinesFinanceChequePaper document

An integrated point of sale terminal for processing multiple payment types including payment by check includes a compact housing, a processor, and memory. The housing has a base shaped to sit on a merchant counter and has a document slot for receiving a check. The processor is disposed in the housing, and the memory is in communication with the processor. The payment terminal is located at the point of sale during use to allow a store merchant to accept multiple payment types. The payment terminal further includes a magnetic ink character recognition device for reading a string of magnetic ink characters on the check. The magnetic ink character recognition device is affixed to the housing at the document slot and is in communication with the processor. Further, the payment terminal includes an imaging device for capturing an image of the check. The imaging device is affixed to the housing at the document slot and is in communication with the processor. The processor is programed to process multiple payment types including processing a checking account transaction when the check is placed in a document slot.

Owner:FIRST DATA +1

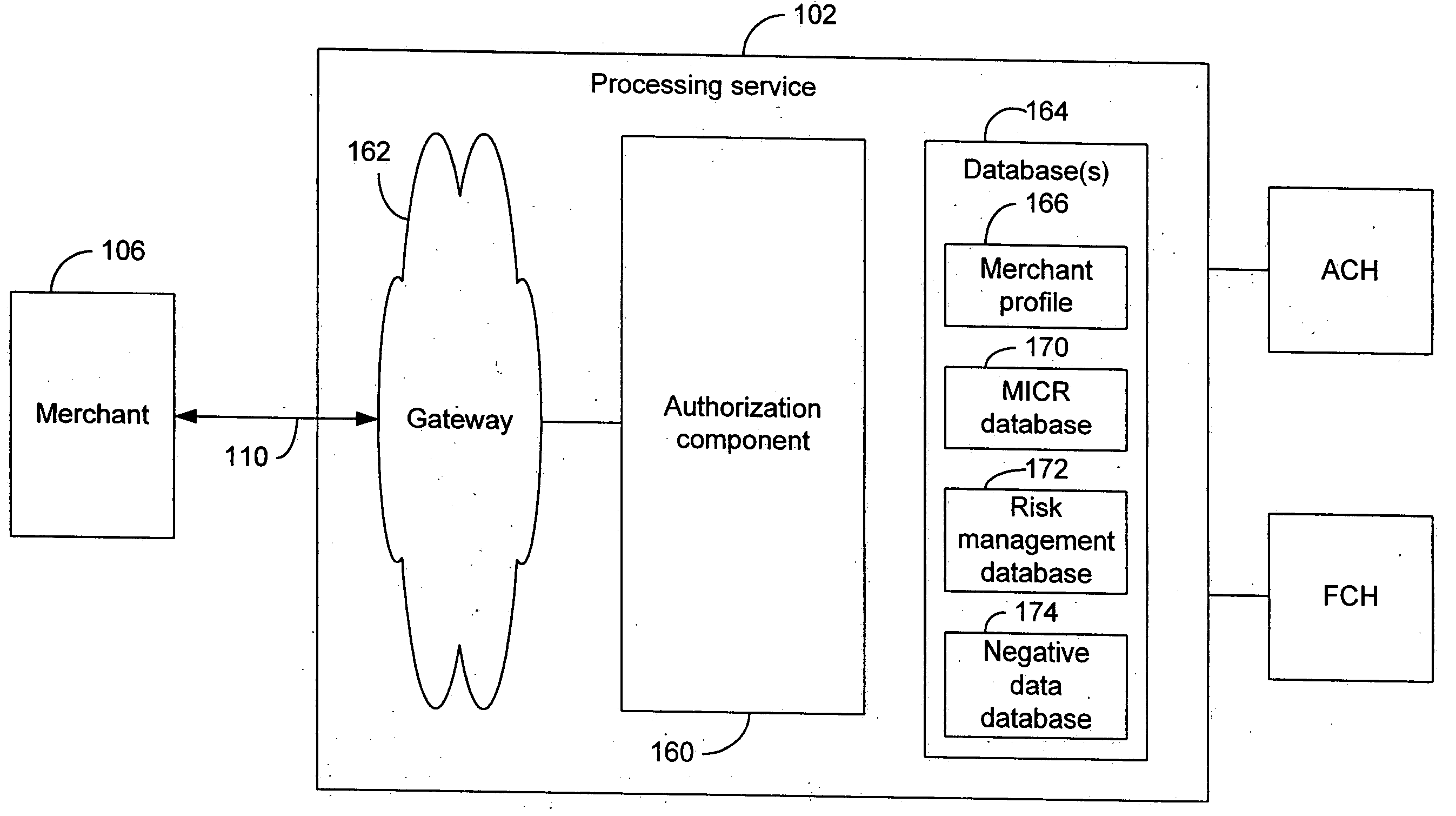

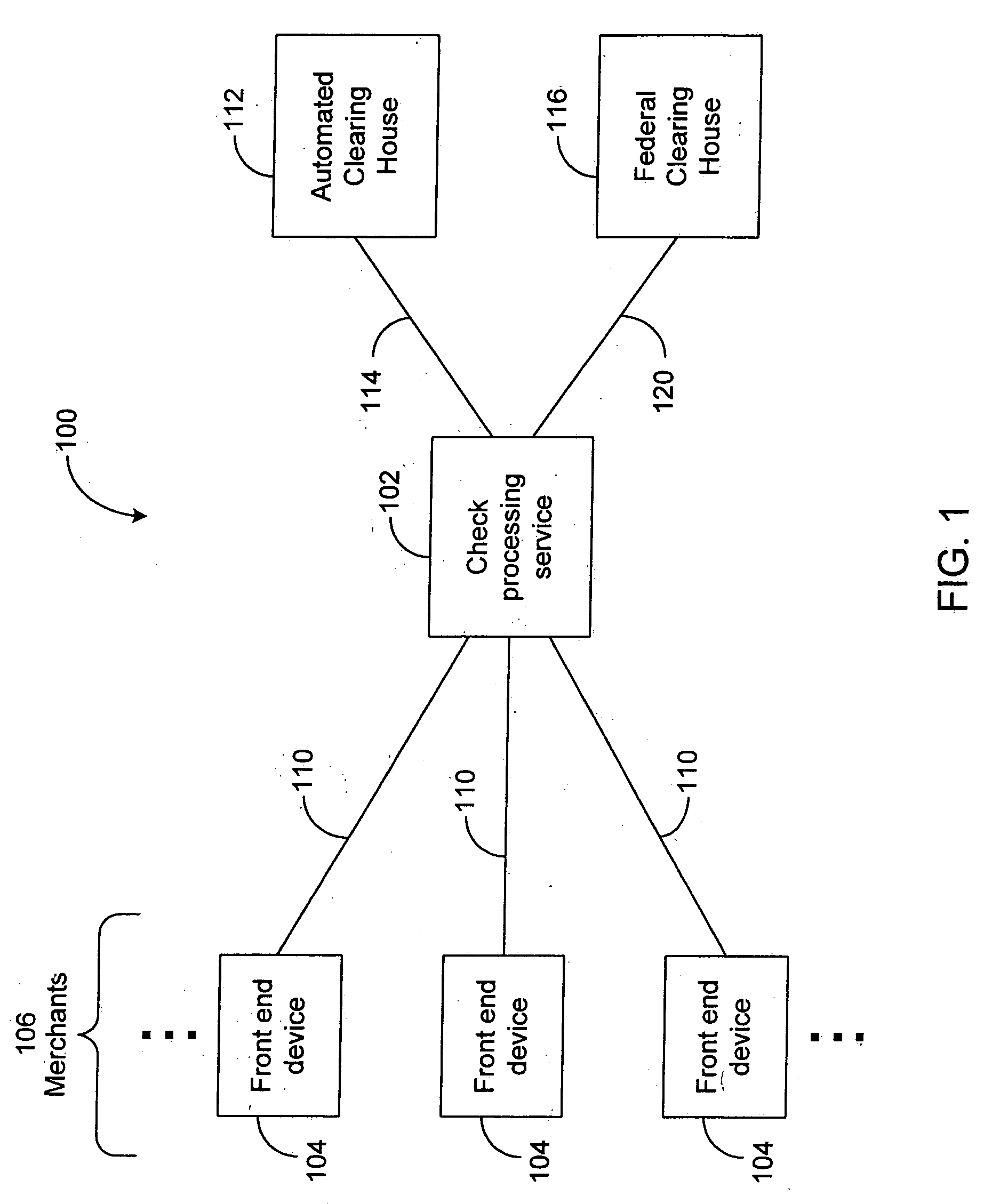

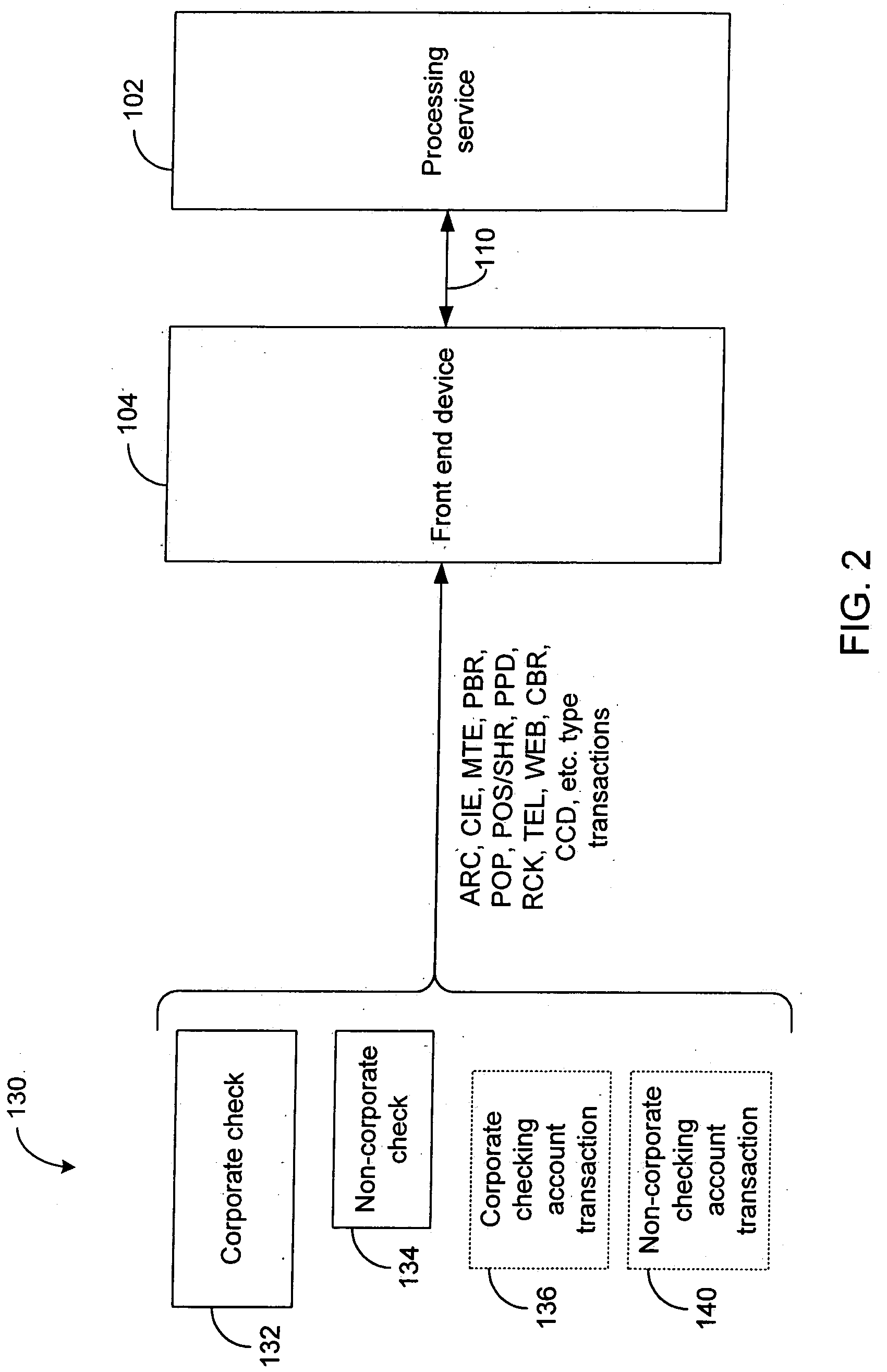

Systems and methods for detecting corporate financial transactions

ActiveUS20050067484A1Facilitate information communicationComplete banking machinesFinanceChequeFinancial transaction

Systems and methods for electronically processing financial transactions involving corporate checks. A front end device at a location associated with a merchant and a check processing service configured to detect and process corporate checks. In one embodiment, the detection of the corporate check is achieved at the front end device by reading of an auxiliary on-us field in the check's magnetic ink character recognition (MICR) line. Such information denoting the check as a corporate check is used by the check processing service to at least partially base its assessment of whether to approve and process the corporate check electronically.

Owner:FIRST DATA

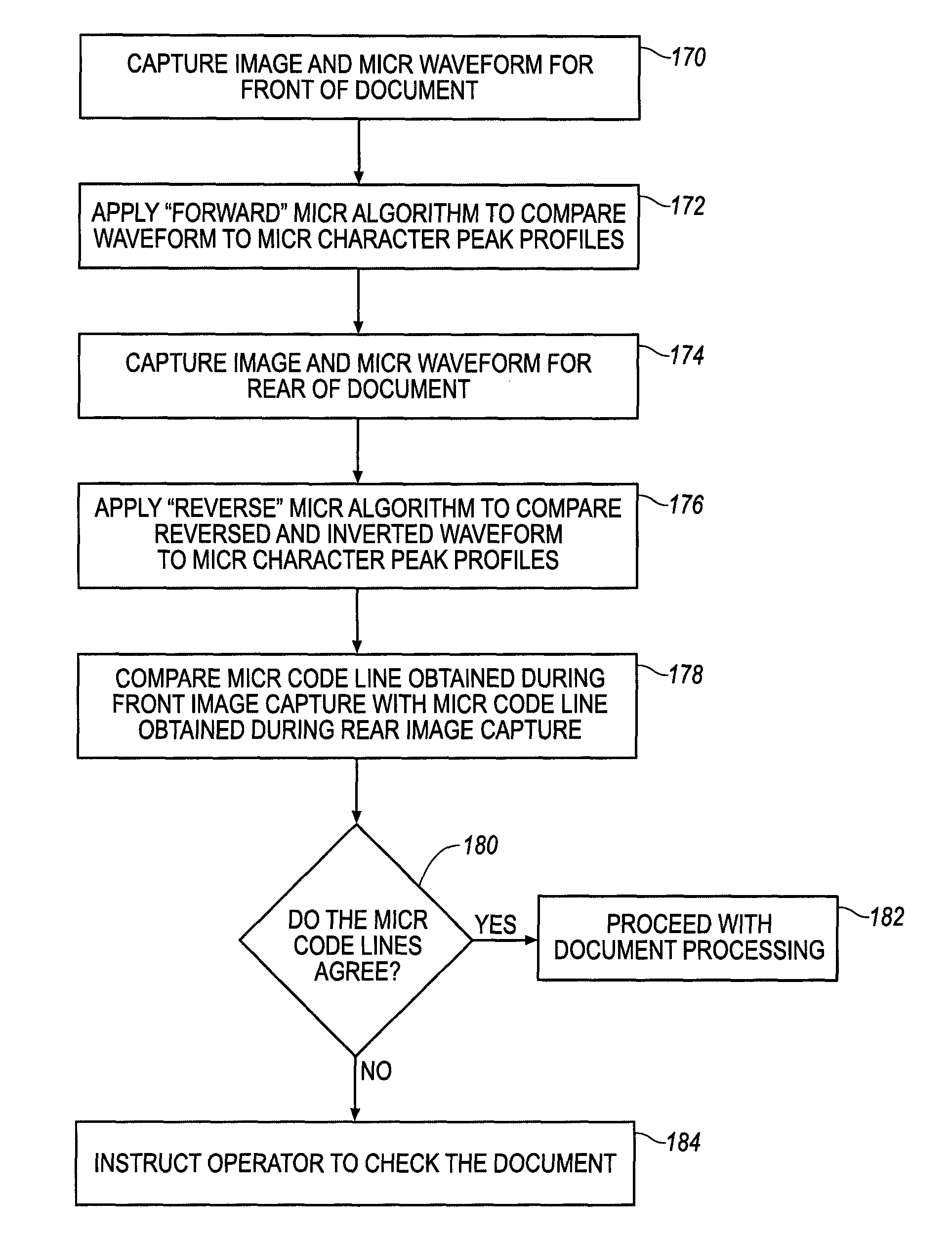

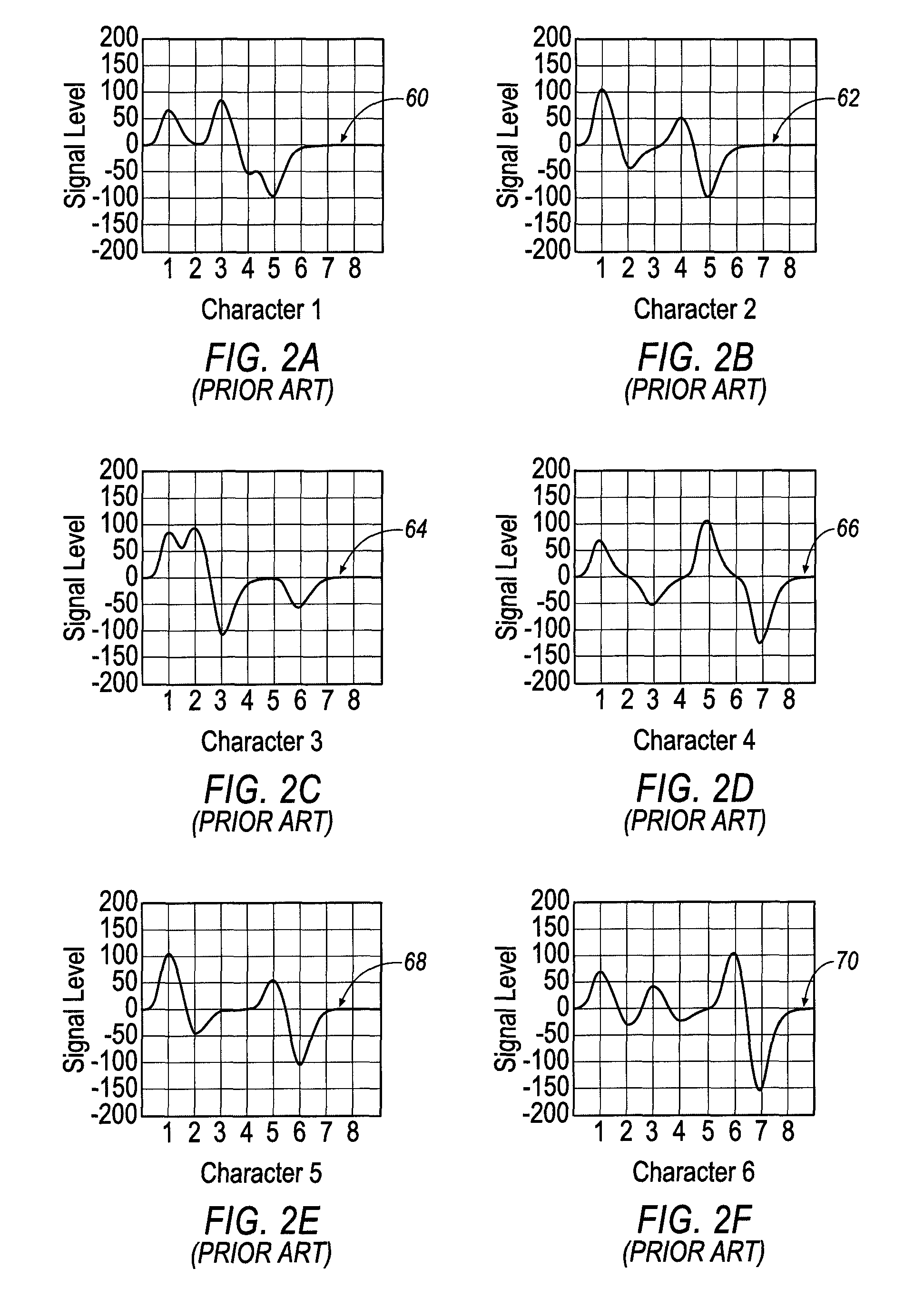

Method and system for linking front and rear images in a document reader/imager

InactiveUS8023718B1Reduce the possibilityReduce the amplitudeFinanceCharacter and pattern recognitionComputer graphics (images)Recognition algorithm

A method for linking front and rear images in a document processing system involves linking the front and rear images by a magnetic ink character code line. The document processing system includes an imaging device and a magnetic ink character recognition (MICR) reader. The method comprises capturing a first image and first MICR waveform for the front side of the document, and capturing a second image and second MICR waveform for the rear side of the document. A forward recognition algorithm is applied to the first waveform to produce a first code line. A reverse recognition algorithm is applied to the second waveform to produce a second code line. The reverse recognition algorithm considers the second waveform as resulting from the document being read from the rear side of the document when processing the second waveform.

Owner:DIGITAL CHECK CORP

Systems and methods for identifying payor location based on transaction data

ActiveUS7783563B2Improve risk assessmentReduce riskFinanceMarketingInformation repositoryTransaction data

Systems and methods are described for building, maintaining, and using a repository of information about payors of second-party checks presented at a check-cashing entity for cashing. In various embodiments, the repository comprises stored information useful for determining the location of a payor of a second-party check. In one embodiment, information from the check that identifies an account on which the check is drawn, such as magnetic ink character recognition (MICR) line information from a paycheck, is used to access a repository of employer location information. In one embodiment, the payor location information is used to determine a proximity between the payor location and the check cashing entity location. In one embodiment, when a check is presented for which stored payor location information is not available, identifying information about the payor and / or the payor location is requested and is added to the repository.

Owner:FIRST DATA

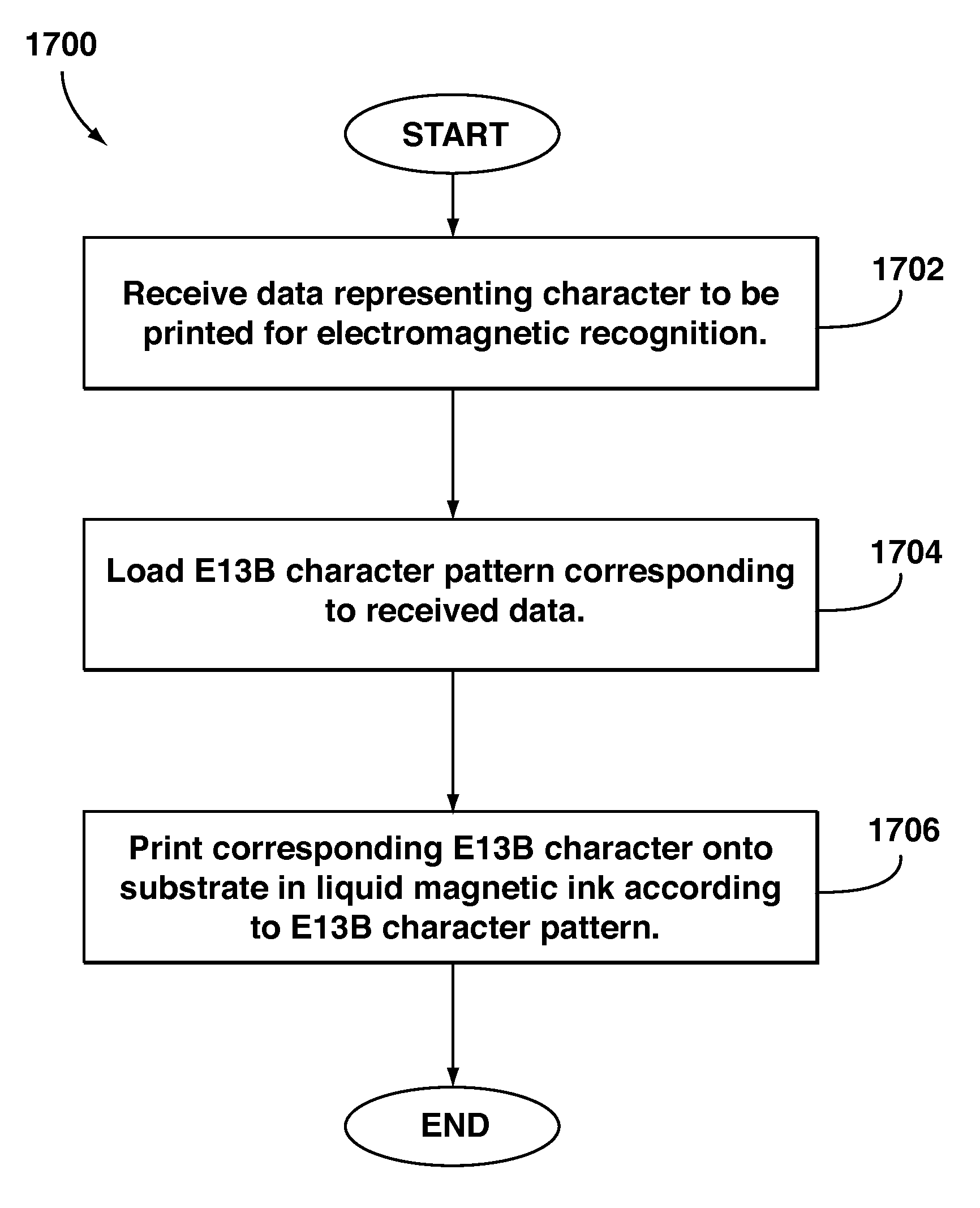

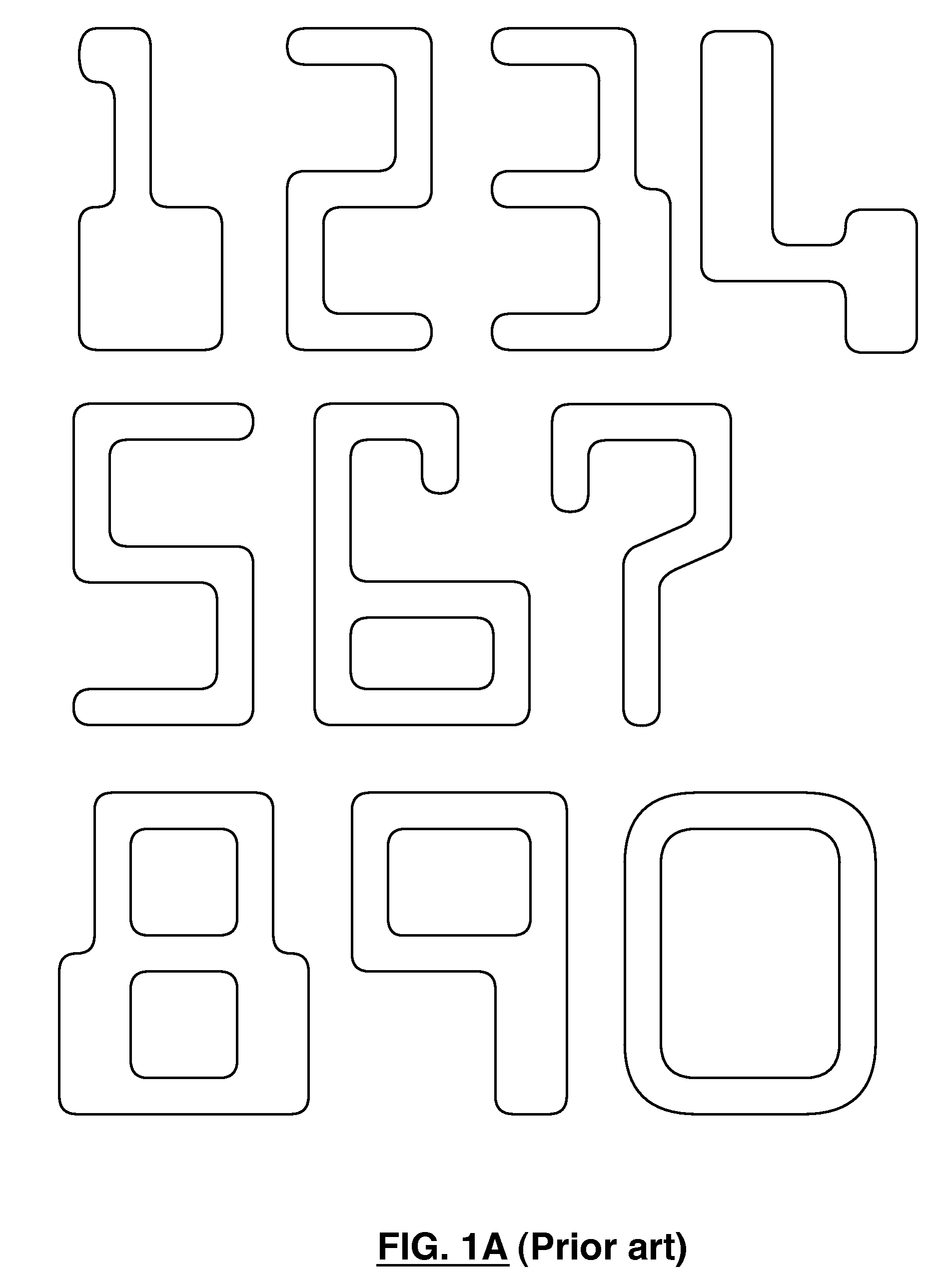

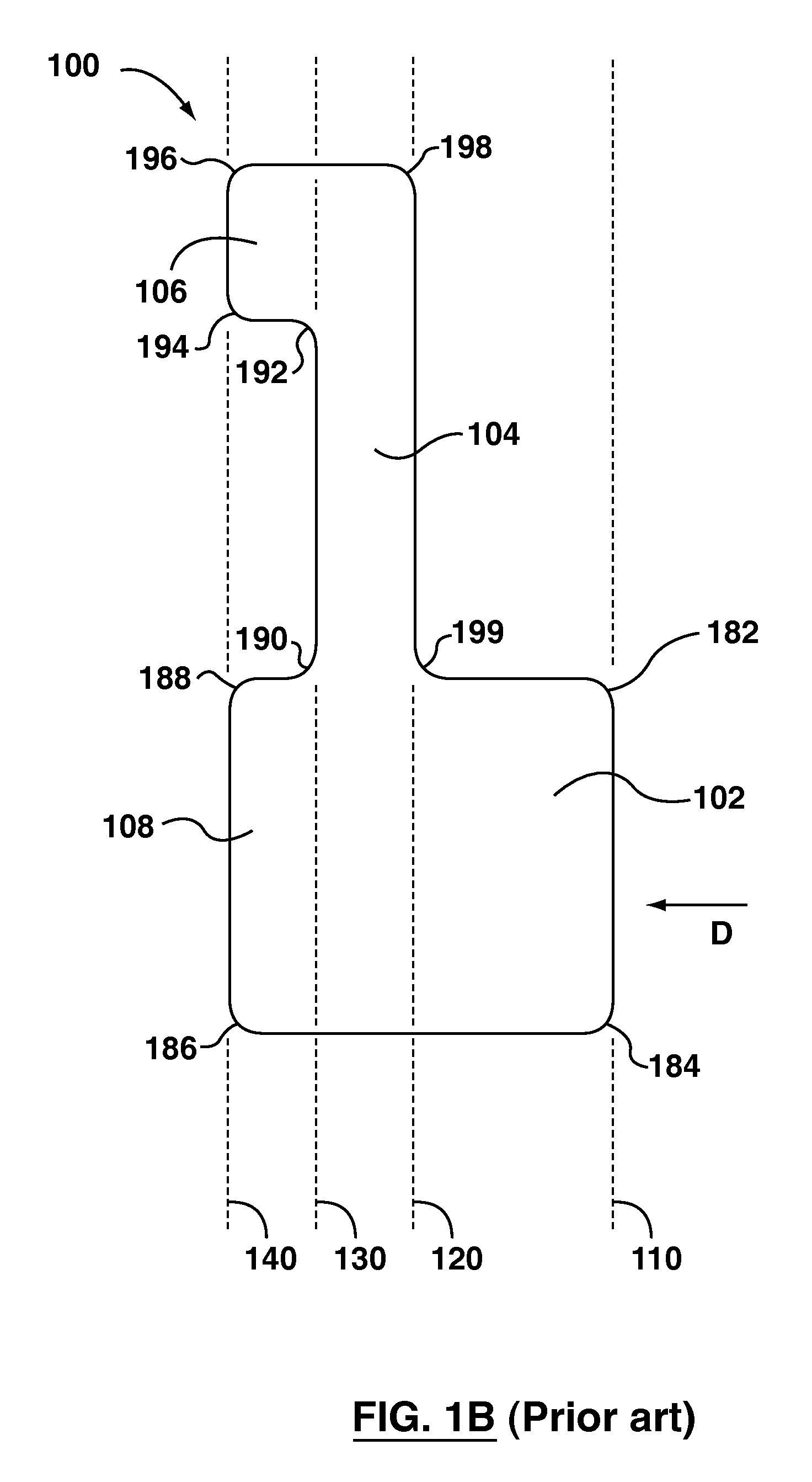

Method for Inkjet Printing of E13B Magnetic Ink Character Recognition Characters and Substrate Having Such Characters Printed Thereon

ActiveUS20100238205A1TypewritersCharacter and pattern recognitionEngineeringElectrical and Electronics engineering

Electromagnetically recognizable E13B characters can be printed onto conventional paper by an inkjet printer using liquid magnetic ink. The printer receives data representing an E13B character, and prints the E13B character onto a substrate according to a modified E13B character pattern. The modified E13B pattern provides for an interior of the E13B character to be substantially completely filled, and includes one or more void arrangements arranged and positioned relative to a corresponding internal detection edge, and sized and shaped, to amplify the difference between the upstream magnetic signal detected on the upstream side of the internal detection edge and the downstream magnetic signal detected on the downstream side of the internal detection edge when an electromagnetic read head reads the resulting printed E13B character.

Owner:DELPHAX TECH

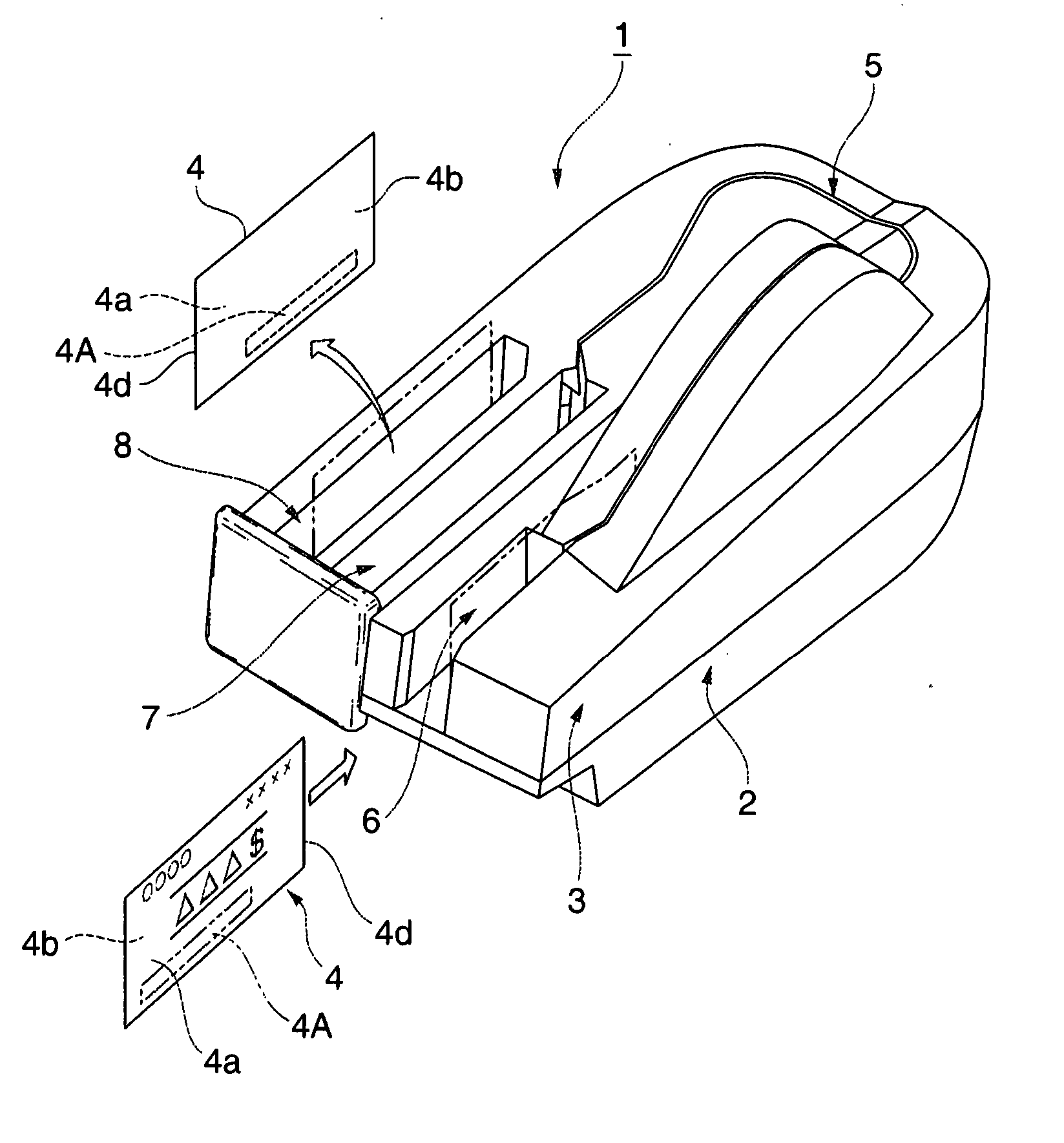

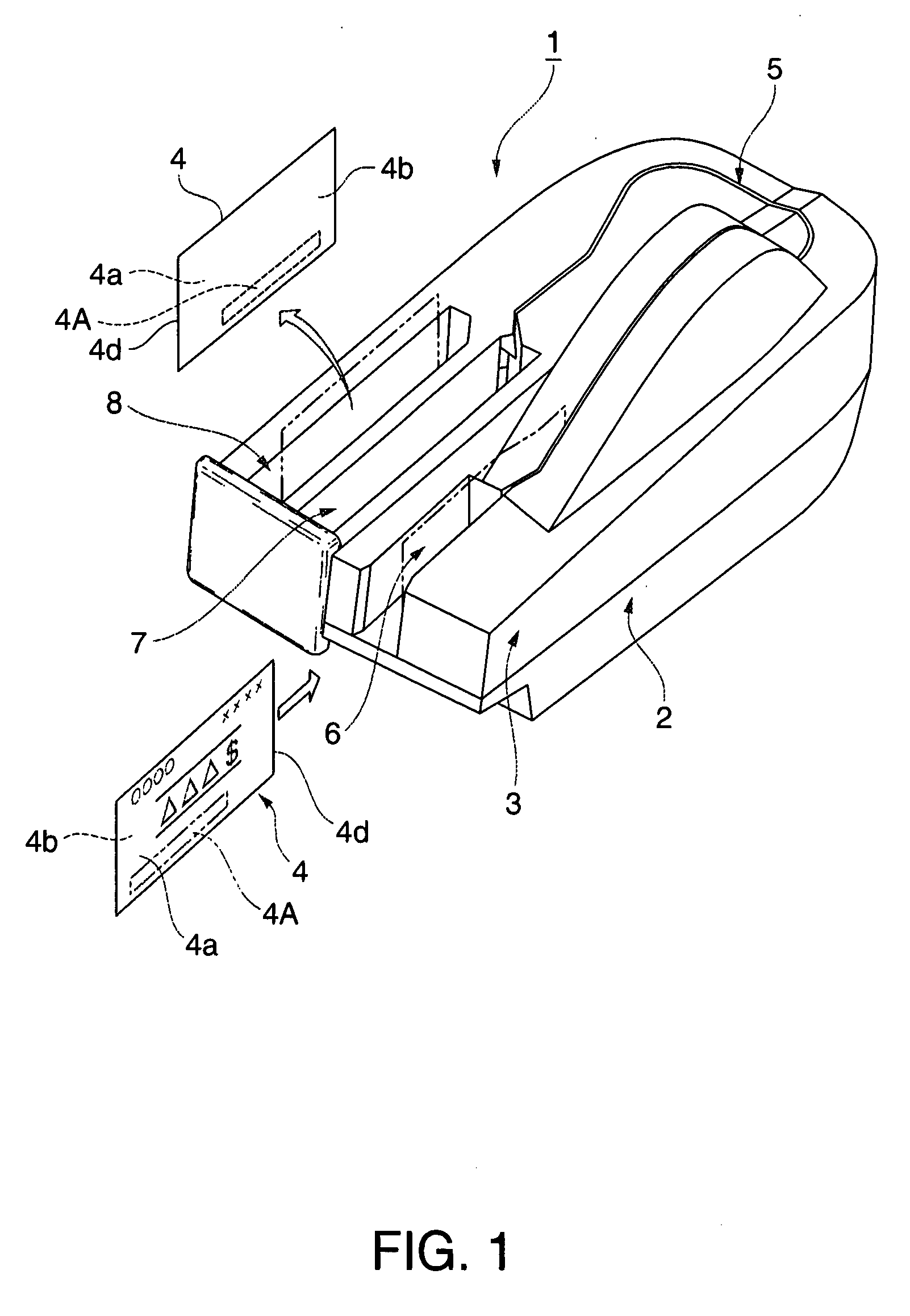

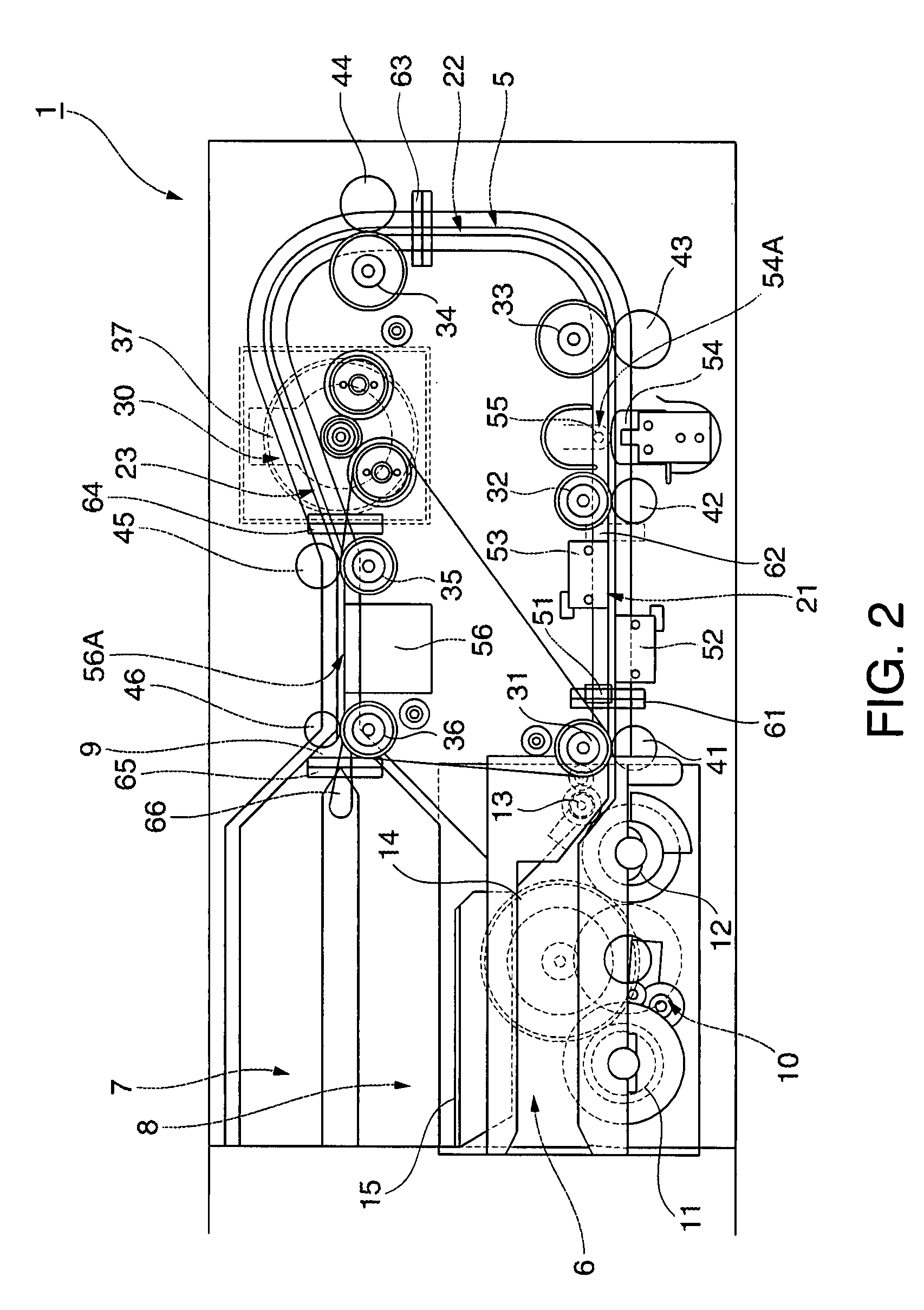

Processing method and apparatus for recording media having printed magnetic ink characters

InactiveUS20080099560A1Efficient executionSeparate processComplete banking machinesSensing by mechanical meansComputer scienceRecording media

A method and apparatus to evaluate transportation of a recording medium based on a detection signal from a magnetic head, and based on the result of this evaluation to efficiently execute a post-processing operation such as sorting the recording media after passing the magnetic head reading position. Using this method the transportation path can be shortened in a recording media processing apparatus such as a check reading device. The check reading device 1 reads a check 4 traveling on a transportation path 5 by means of a magnetic head 54, and makes an evaluation to determine (ST21, 25) that the top and bottom of the check are inverted or the medium is paper on which magnetic ink characters are not printed if there is no change in the detection signal. If magnetic ink characters cannot be recognized from the detection signal, a magnetic ink character recognition process is used to evaluate the detection signal patterns that are output when the magnetic ink characters are read from the back side (ST23, 26), whereupon the front and back of the check 4 are determined to be reversed if recognition is possible (ST27, 28), and the top and bottom of the check 4 are determined to be inverted if recognition is not possible (ST27, 29). Transportation is paused (ST6) so that the check 4 does not reach the first and second check discharge units 7 and 8 or the printing mechanism 56 until this determination can be completed. Transportation of the check 4 resumes when the determination is completed (ST9, ST13), and the check 4 is routed to the first check discharge unit 7 or second check discharge unit 8 or is printed by the printing mechanism 56. The transportation path 5 can therefore be shortened and the check reading device 1 can be rendered small.

Owner:SEIKO EPSON CORP

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com