Remote check deposit

a check and deposit technology, applied in the field of remote check deposits, can solve the problems of hassle of rushing to a branch, and achieve the effects of avoiding further processing, improving payment system, and facilitating check truncation

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Benefits of technology

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

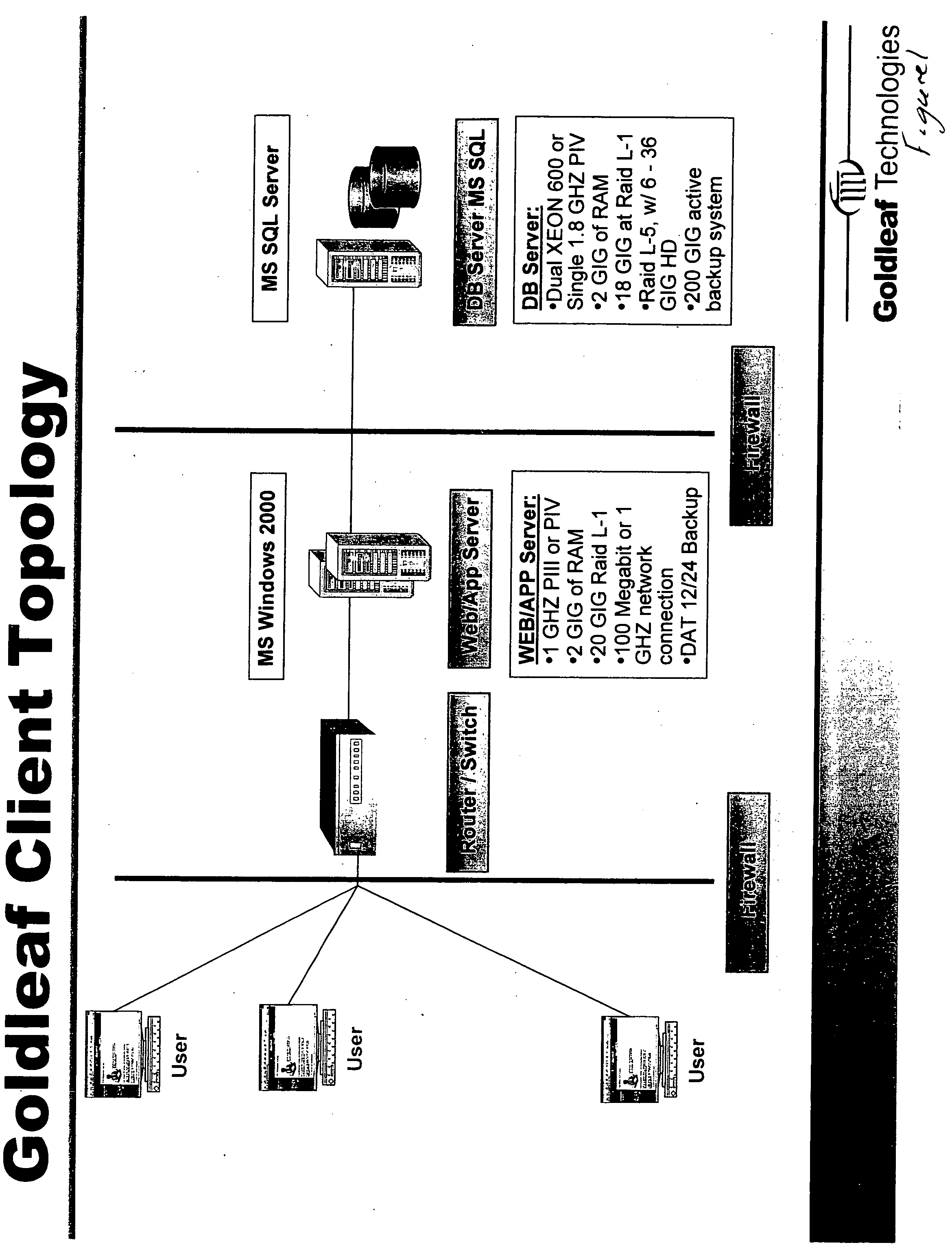

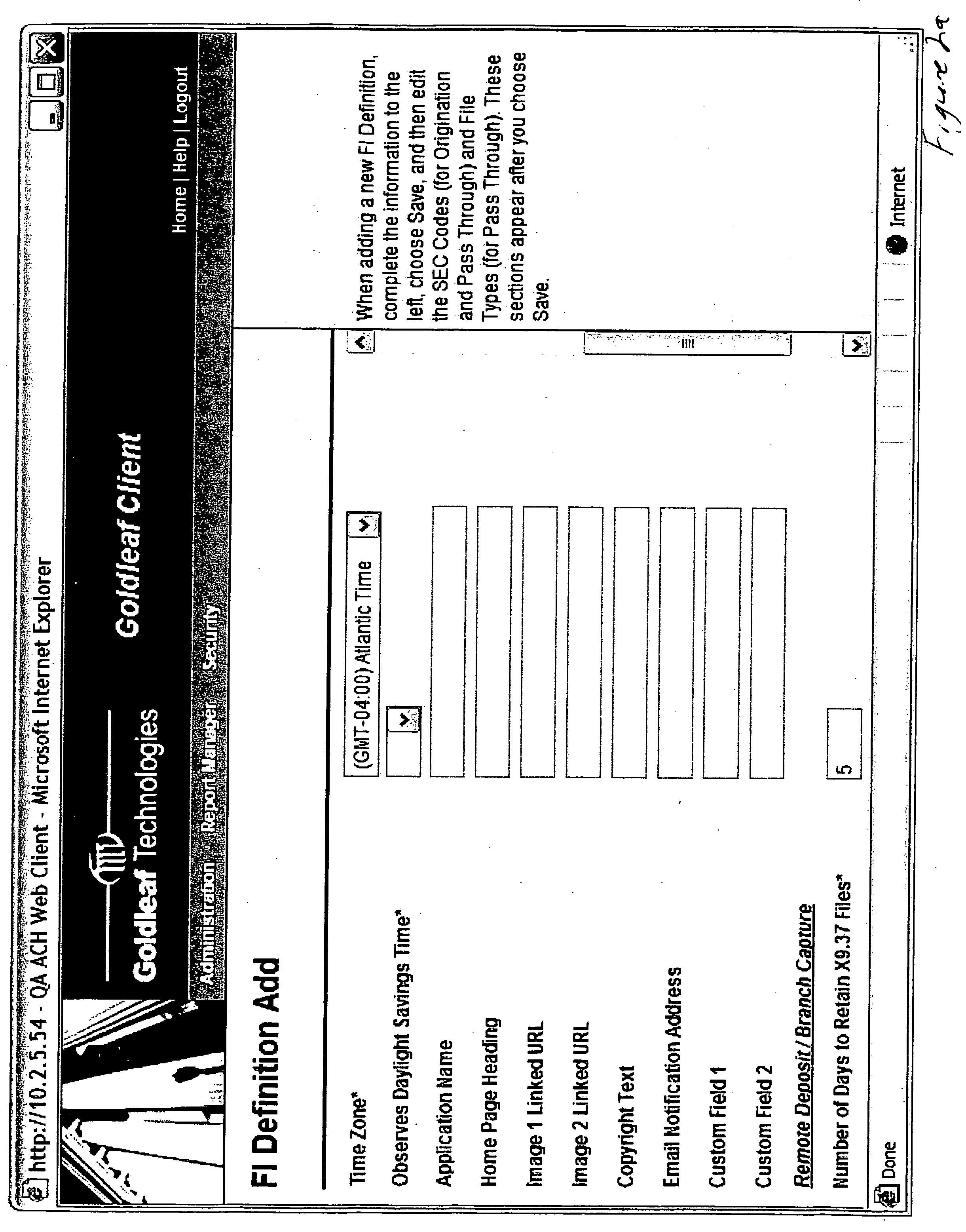

[0029] A system in accordance with the principles of the present invention equips a financial institution's business clientele with the ability to deposit checks remotely without physically depositing checks to a financial institution's branch location. A system in accordance with the principles of the present invention allows checks to be truncated electronically at the business site, deposited online, and picked up by the financial institution as a ‘Check 21 file’. The file may then be processed by any image exchange or check processing system or printed as a substitute check.

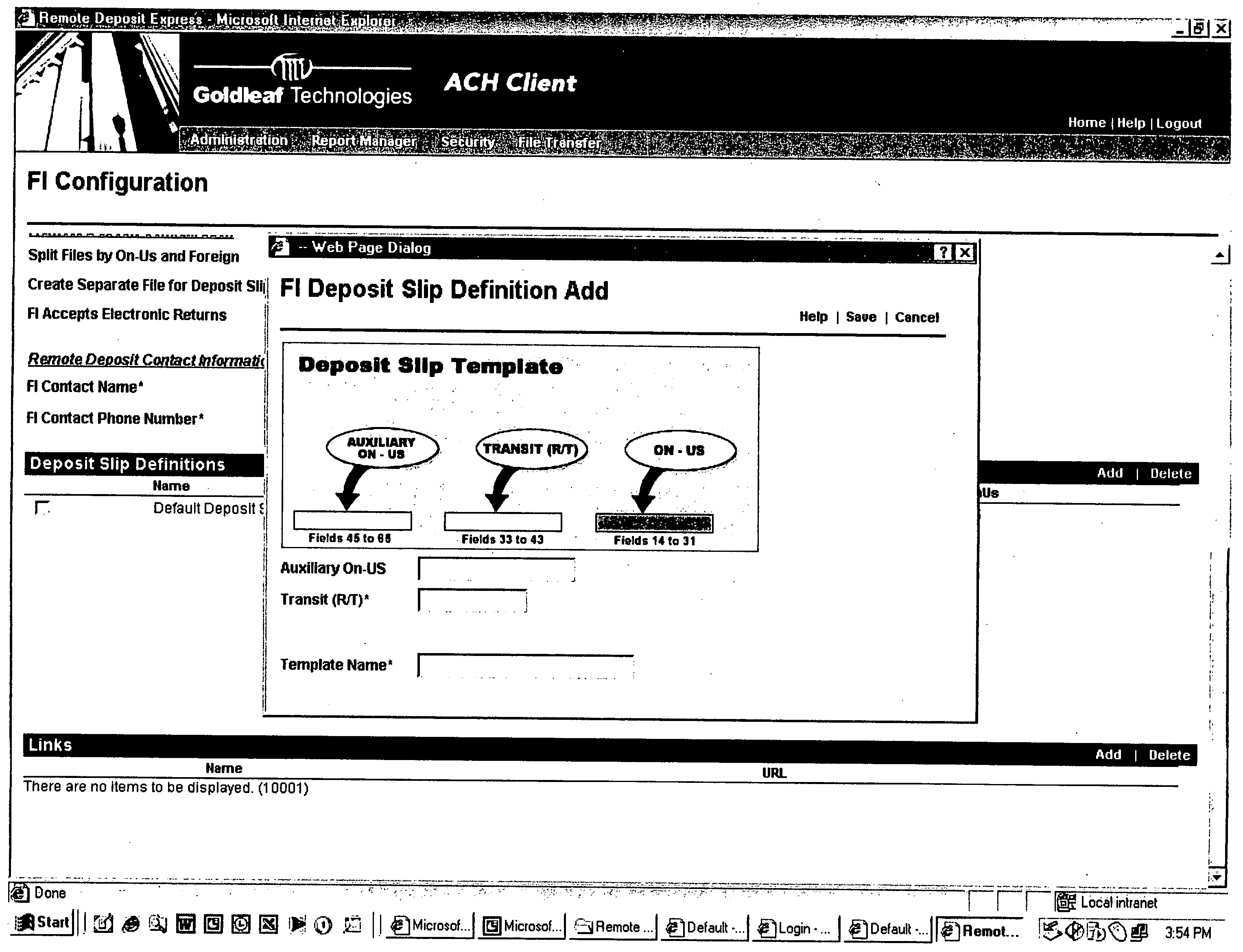

[0030] In accordance with the principles of the present invention, a business accesses the web using an Internet browser. A check scanner captures the image of the front and back of the check and the associated Magnetic Ink Character Recognition (MICR) data. Alternatively, a standalone scanning system can be used to capture check images and MICR data to create a “Check” file and the resulting file can be del...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com