Patents

Literature

757results about "Paper currency actuation" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

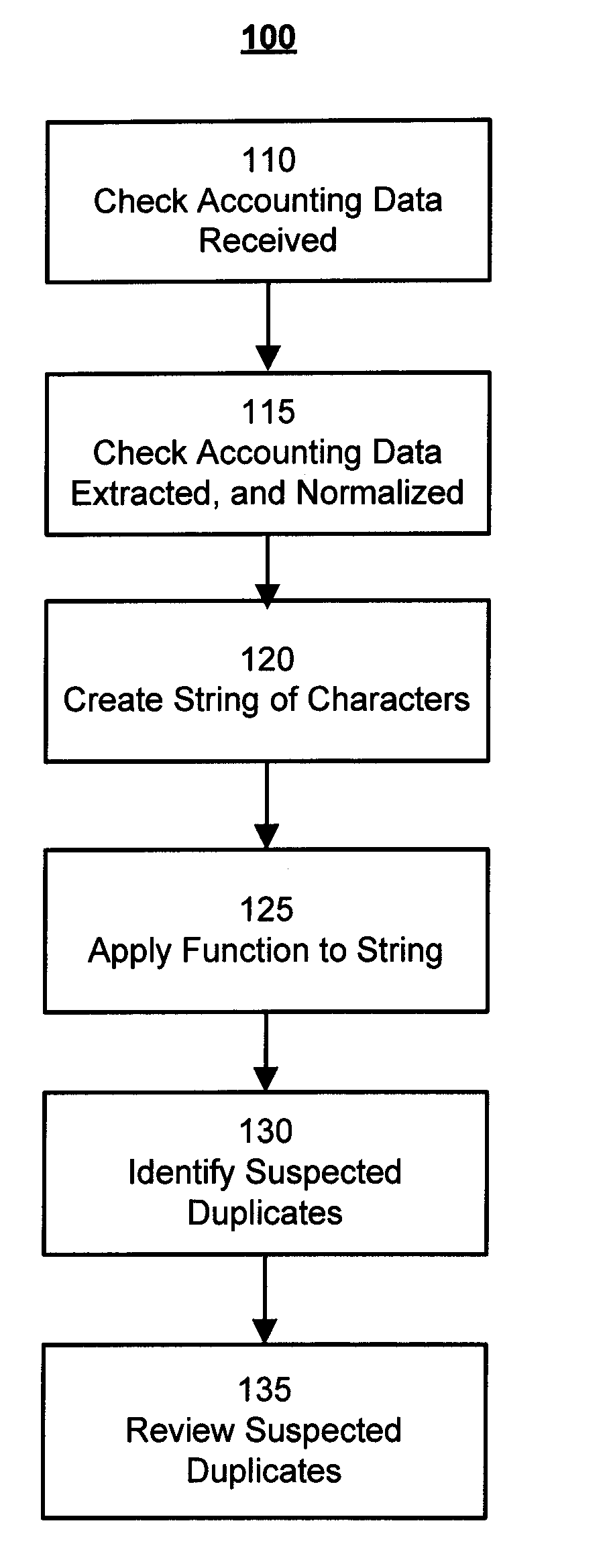

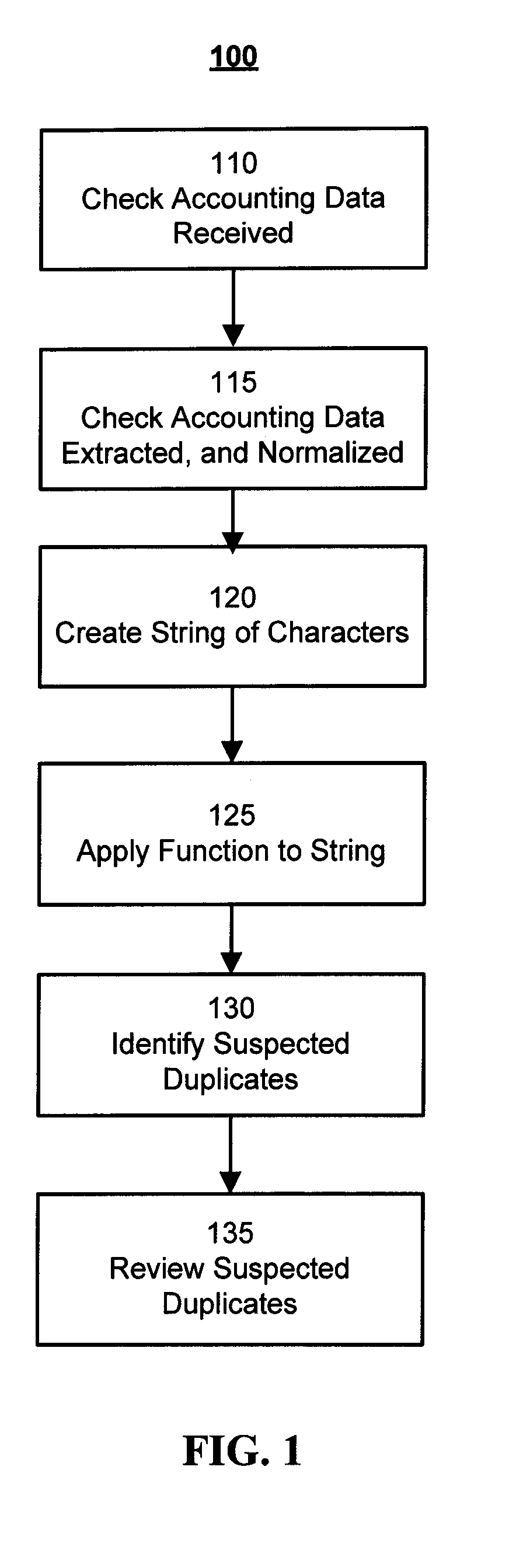

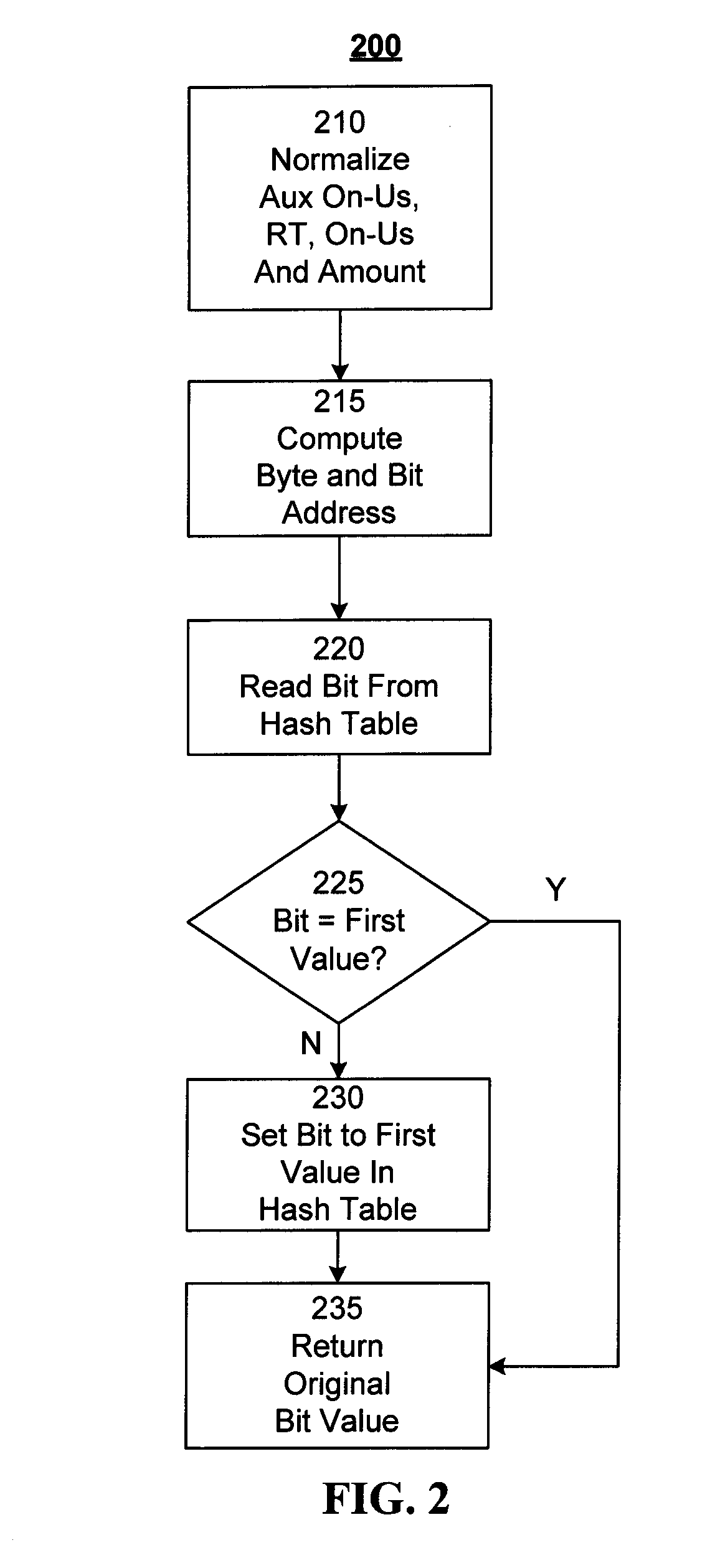

Method and System for Duplicate Check Detection

ActiveUS20100098318A1Reduce false positive rateMinimize table sizeComplete banking machinesFinanceHash functionBloom filter

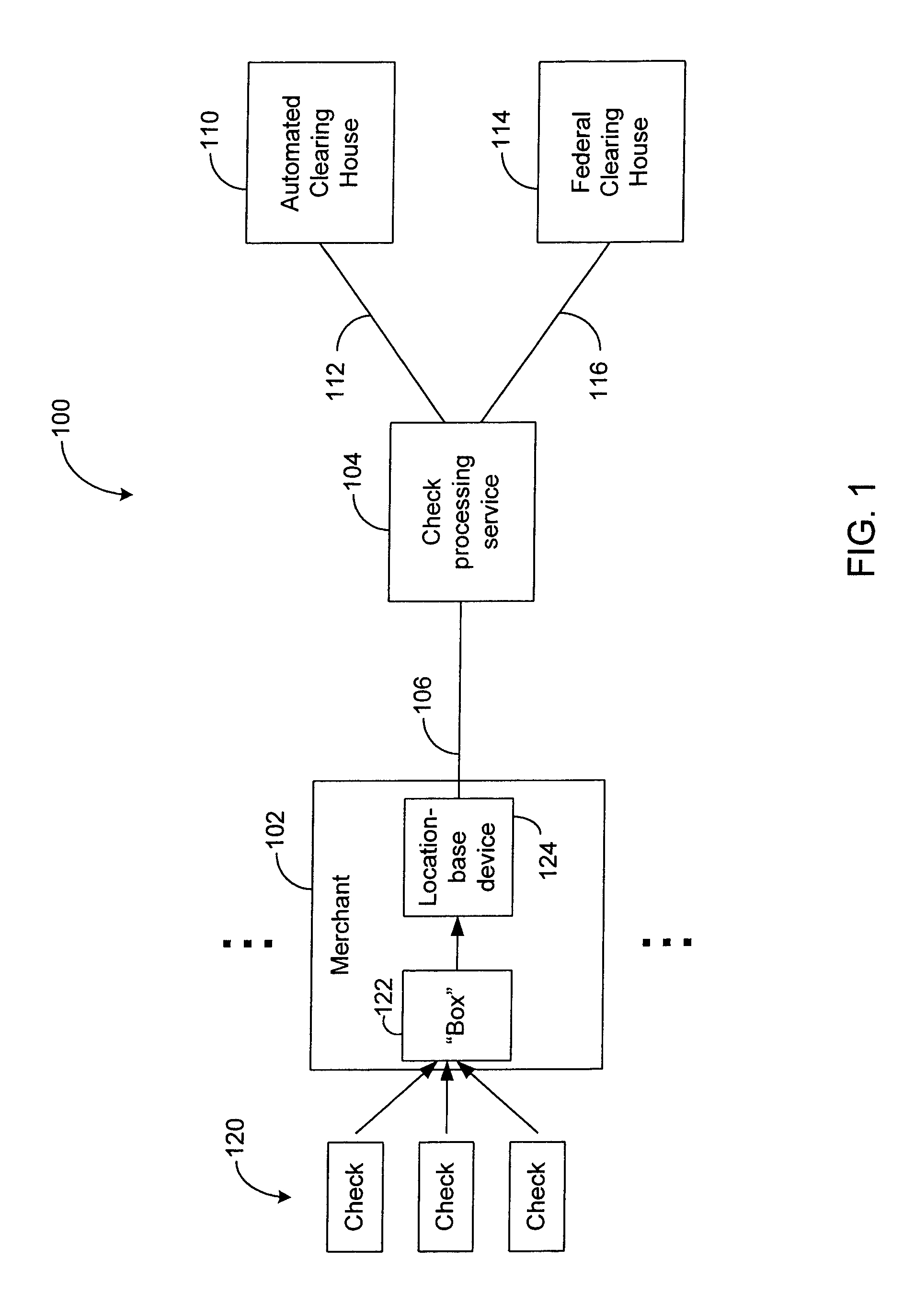

A system and method for detecting duplicate checks during processing. The duplicate detection may be performed by a financial institution, such as a bank. The method may be implemented on a computer based system. The duplicate detection method may be automated. The method may be applied to incoming check files prior to processing of the check data to prevent processing of duplicate checks. The system and method may use a function, such as a hash function, to perform the duplicate detection. Other functions, such as a Bloom filter which may use multiple hash functions, may be used to perform the duplicate detection.

Owner:JPMORGAN CHASE BANK NA

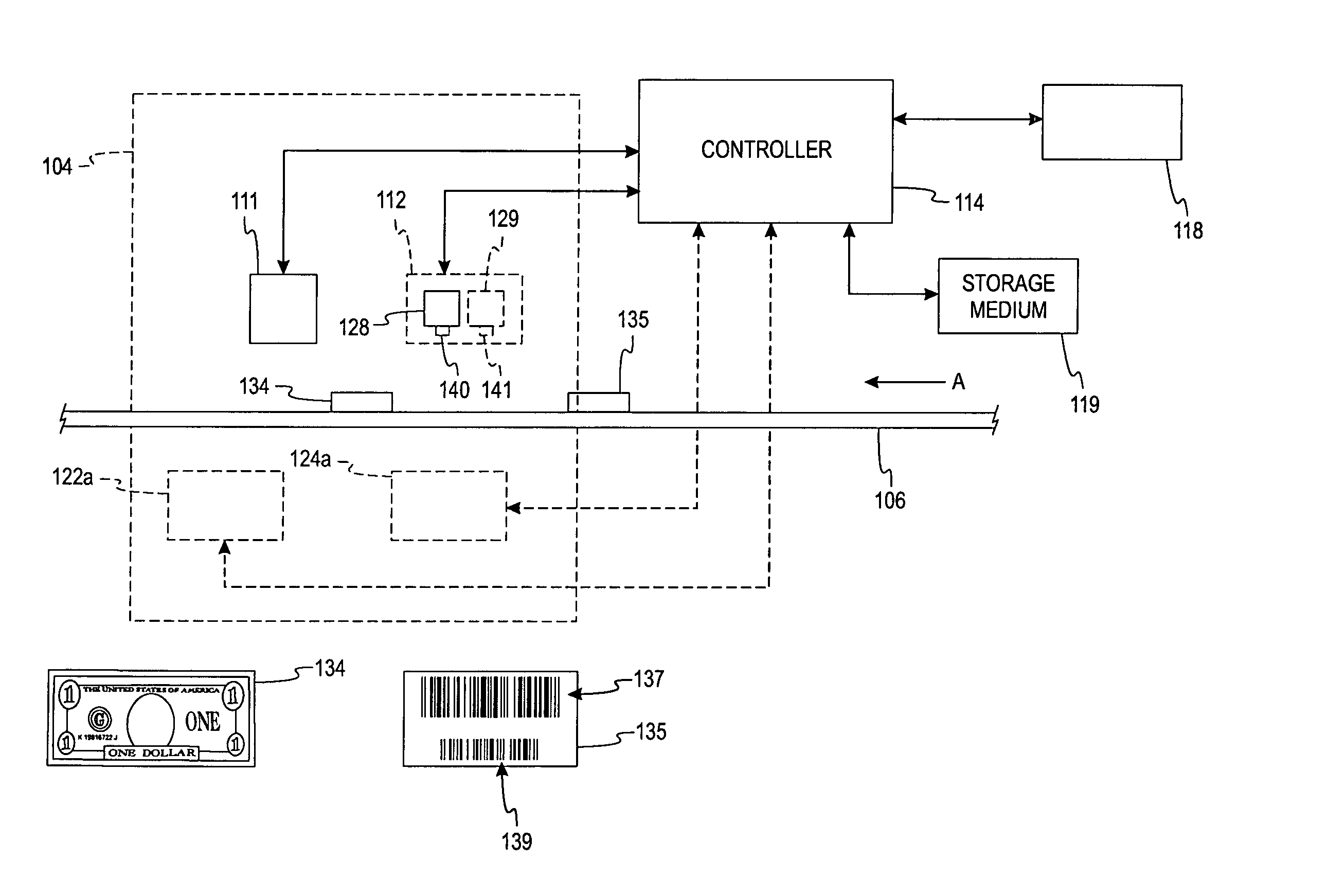

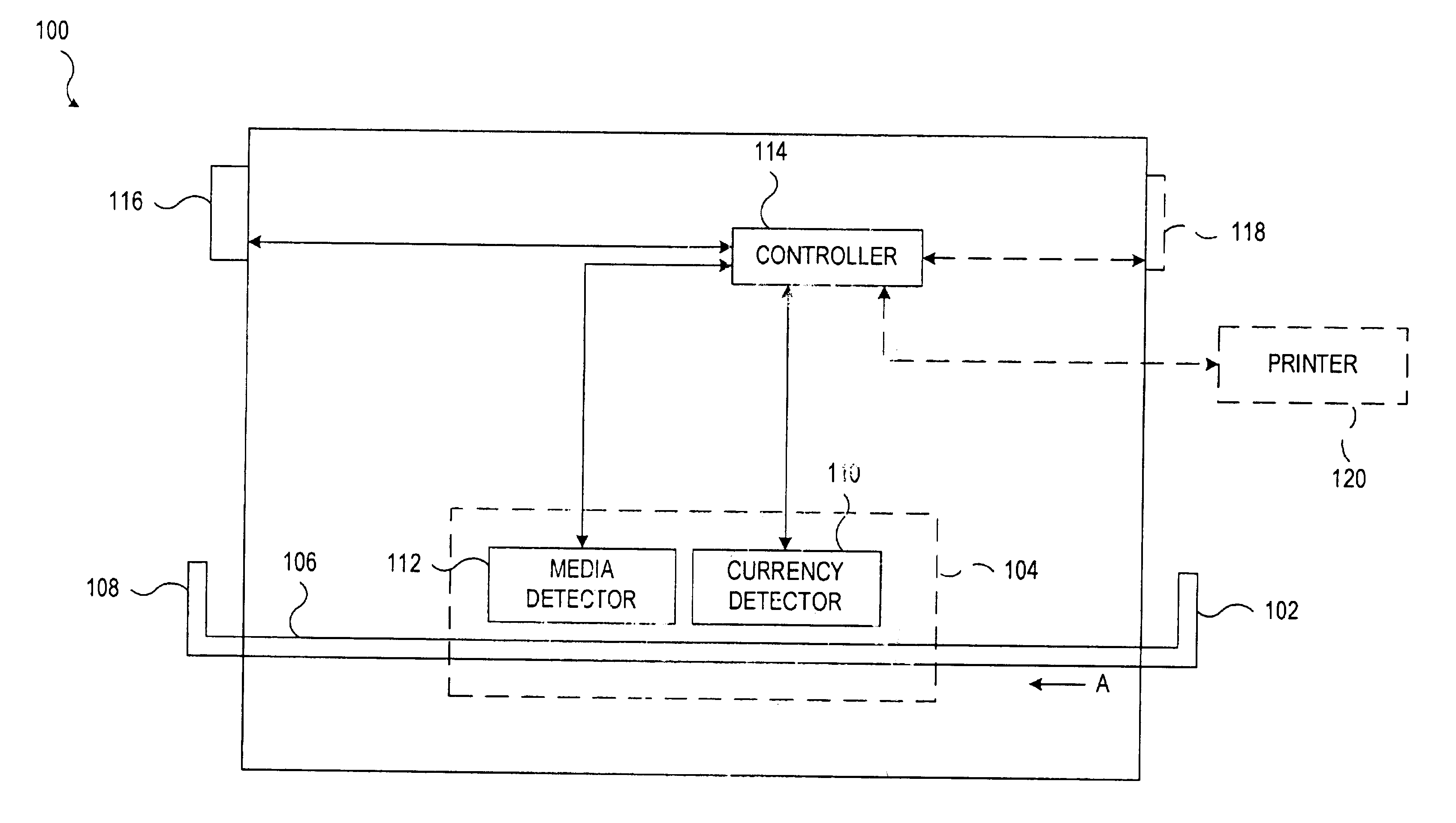

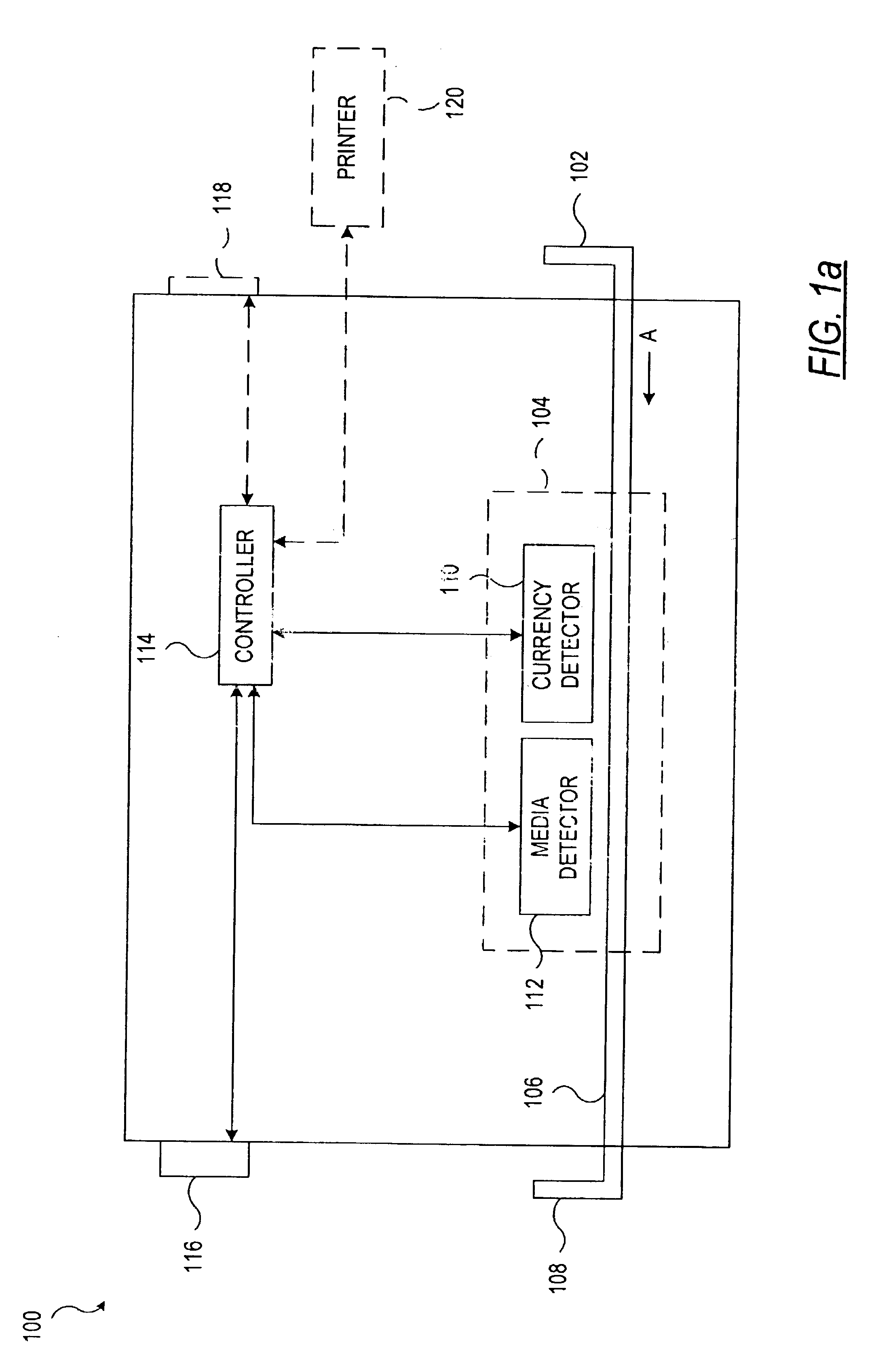

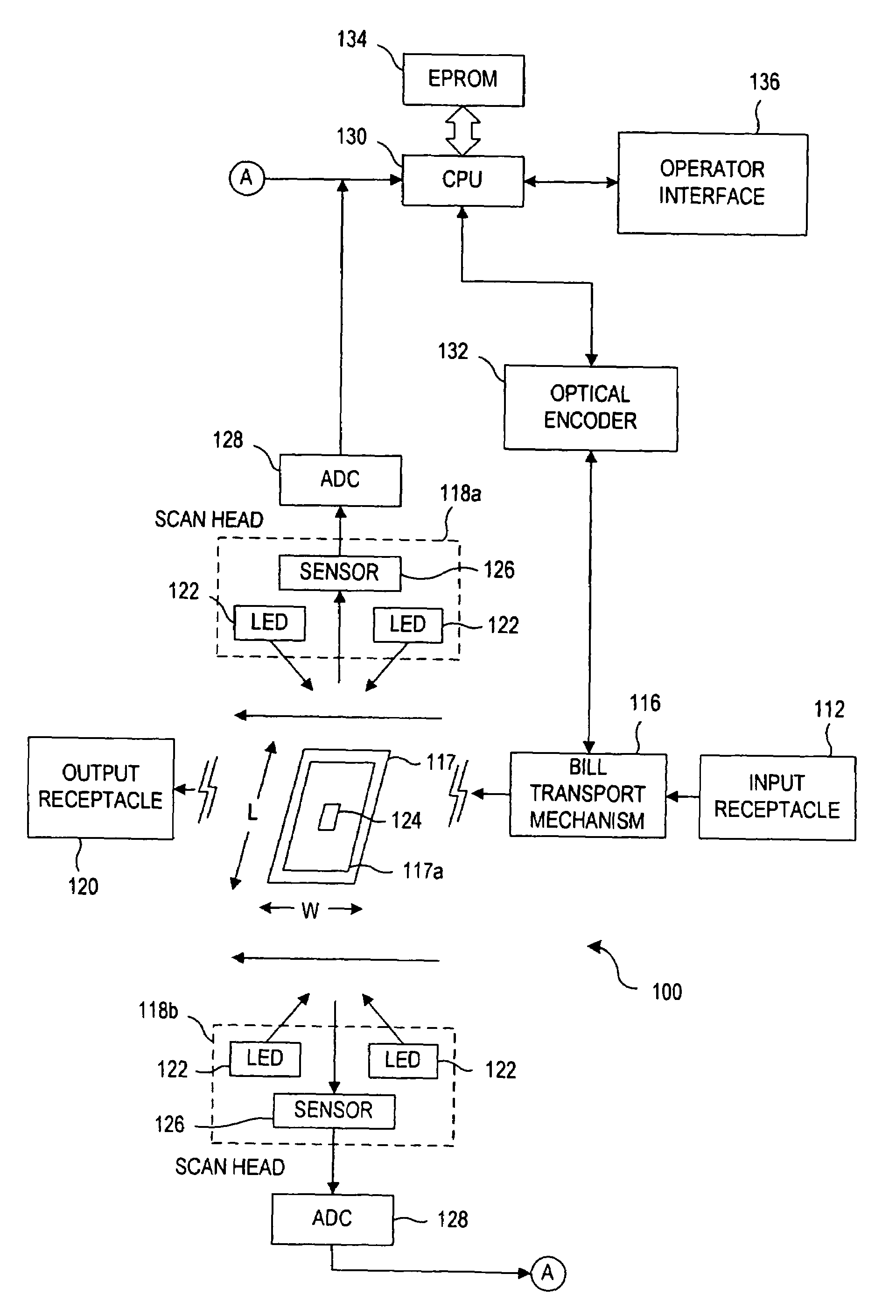

System and method for processing currency bills and documents bearing barcodes in a document processing device

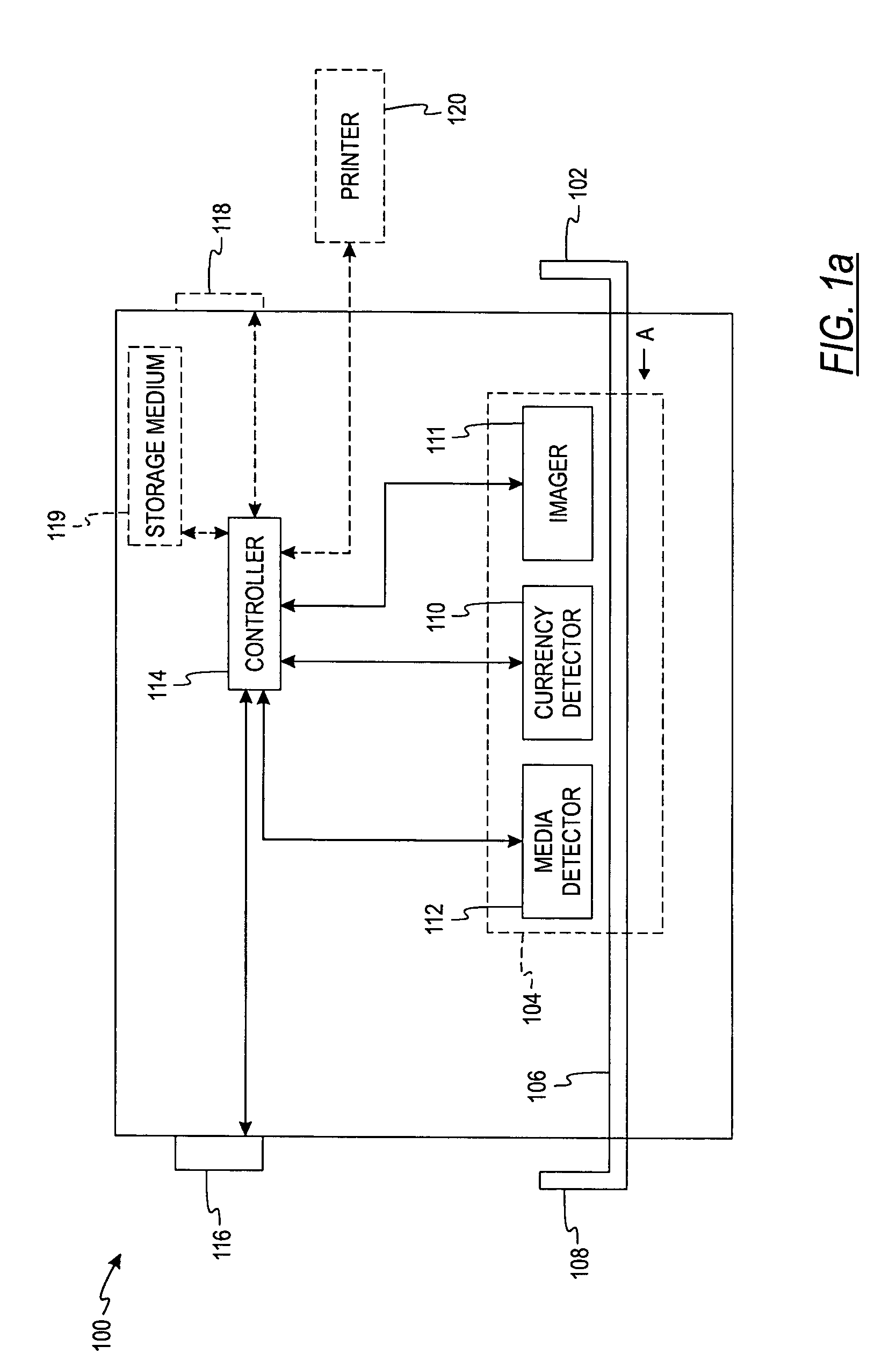

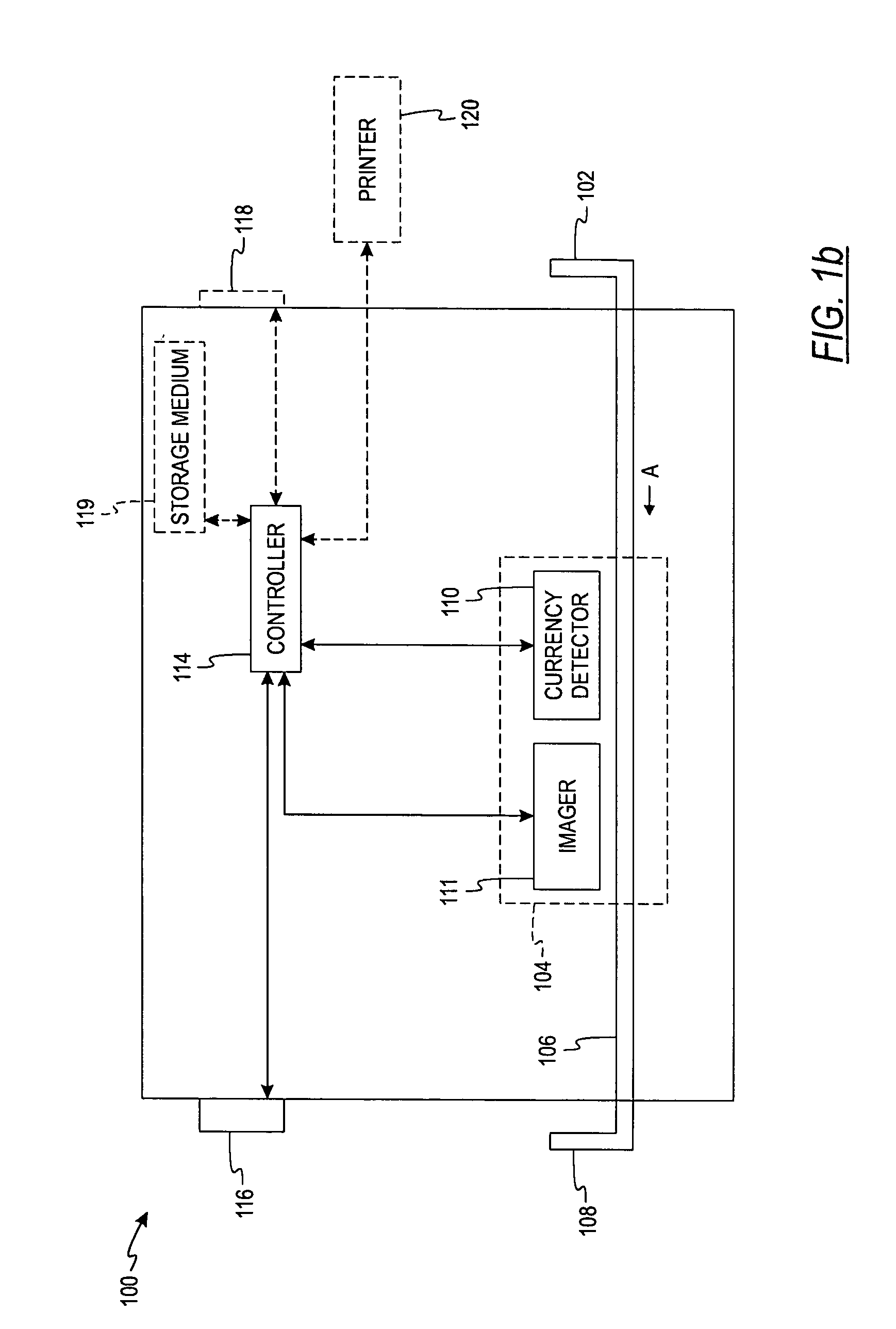

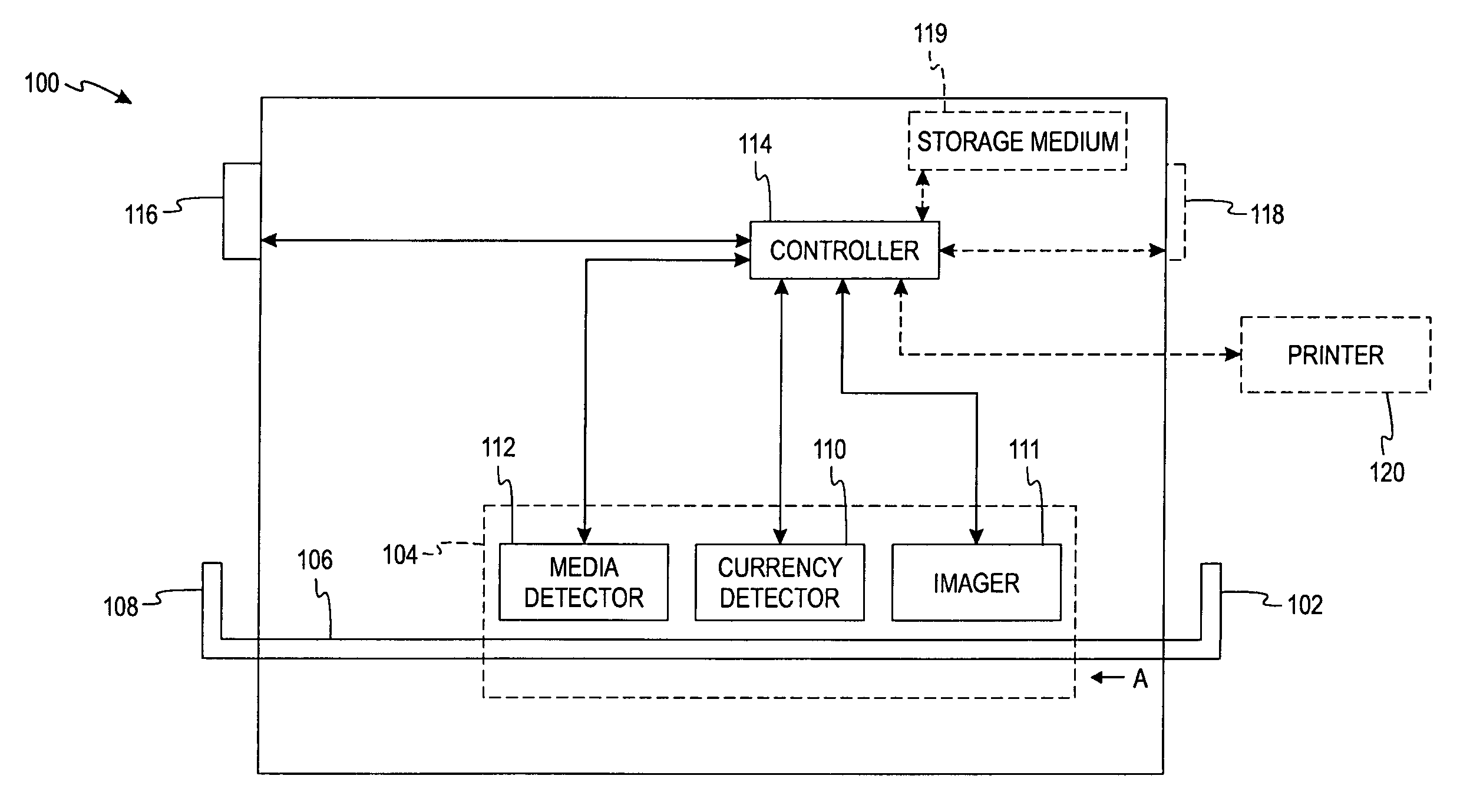

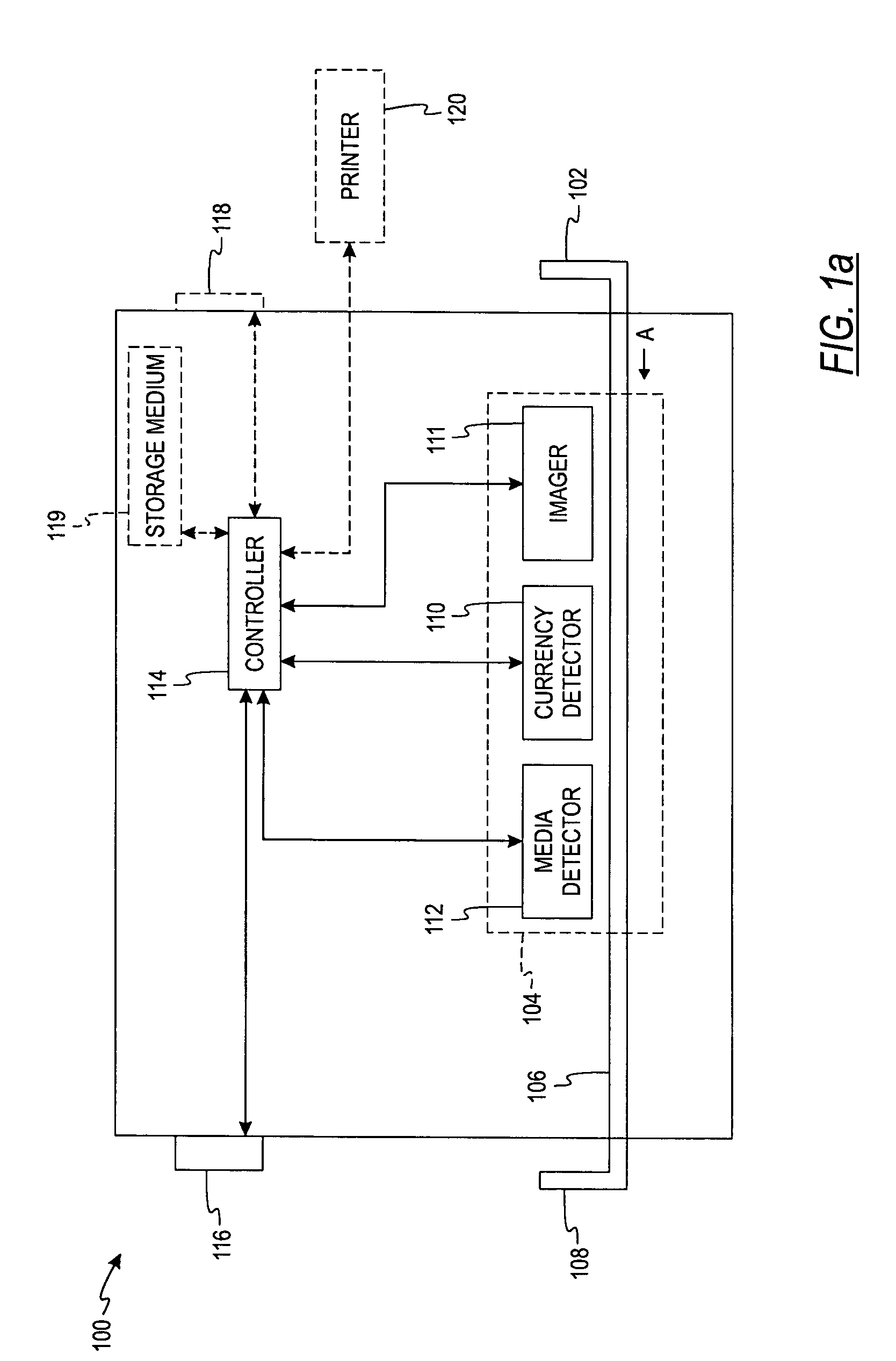

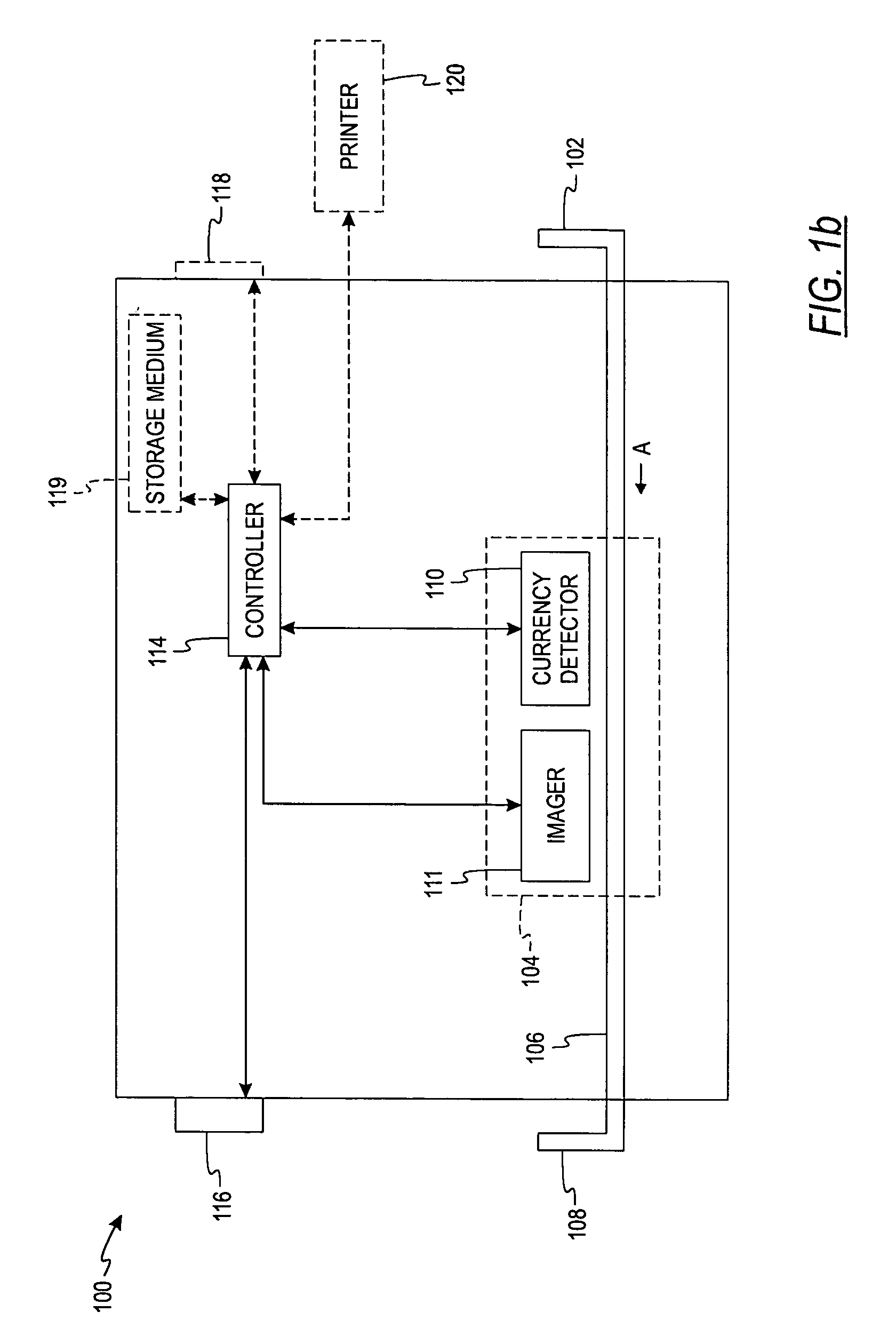

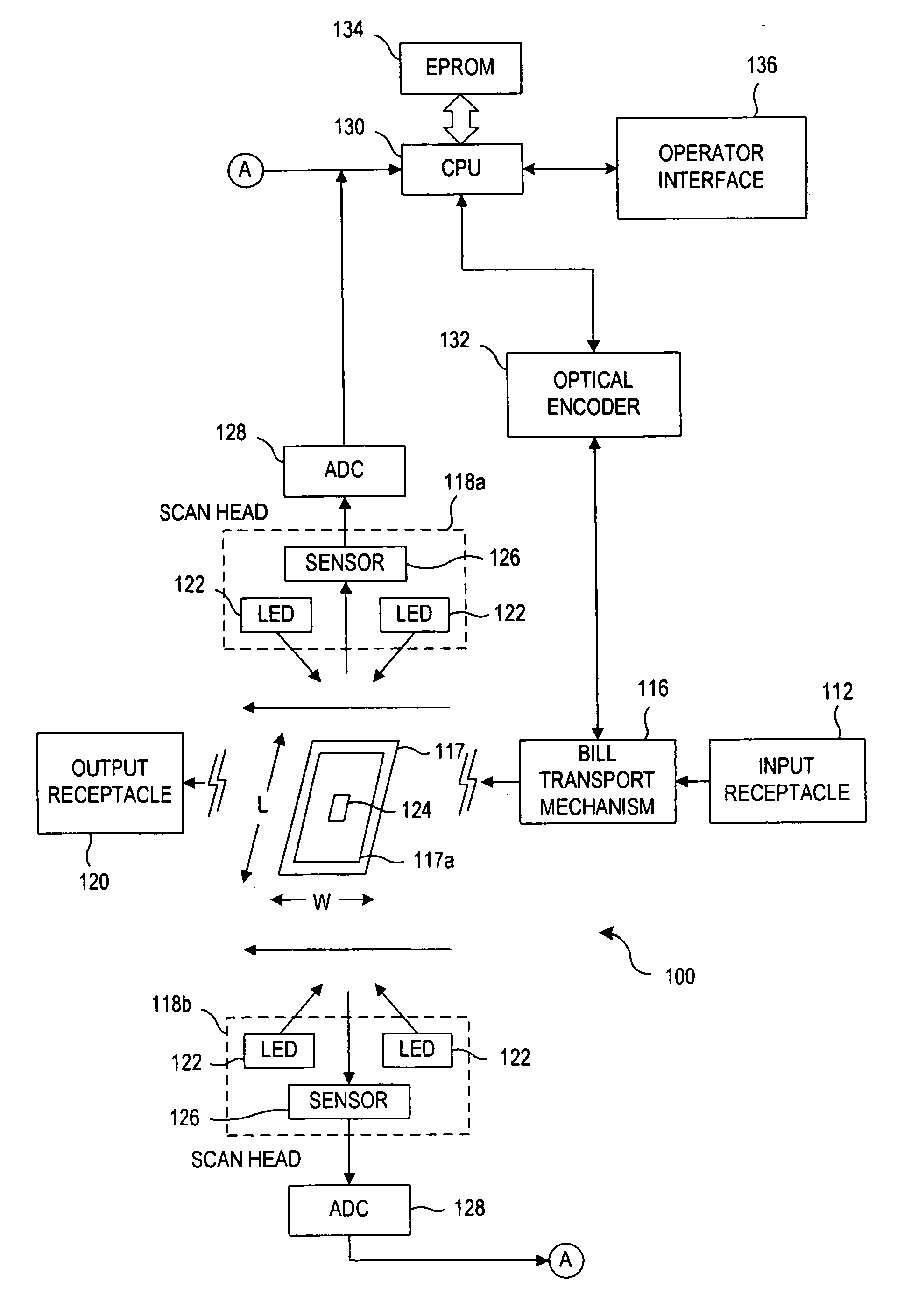

A document processing device having an evaluation region disposed along a transport path between an input and output receptacle capable of processing both currency bills and substitute currency media having at least one indicia. The evaluation region includes at least one of a currency detector, a media detector, and an imager for detecting predetermined characteristics of currency bills and substitute currency media. A controller coupled to the evaluation region controls the operation of the document processing device and receives input from and provides information to a user via a control unit. In some embodiments, the document processing device may have any number of output receptacles, and the control unit allows the user to specify which output receptacle receives which type of document. An optional coin sorter may be coupled to the document processing device to allow document and coin processing. The document processing device may be coupled to a network to communicate information to devices linked to the network.

Owner:CUMMINS-ALLISON CORP

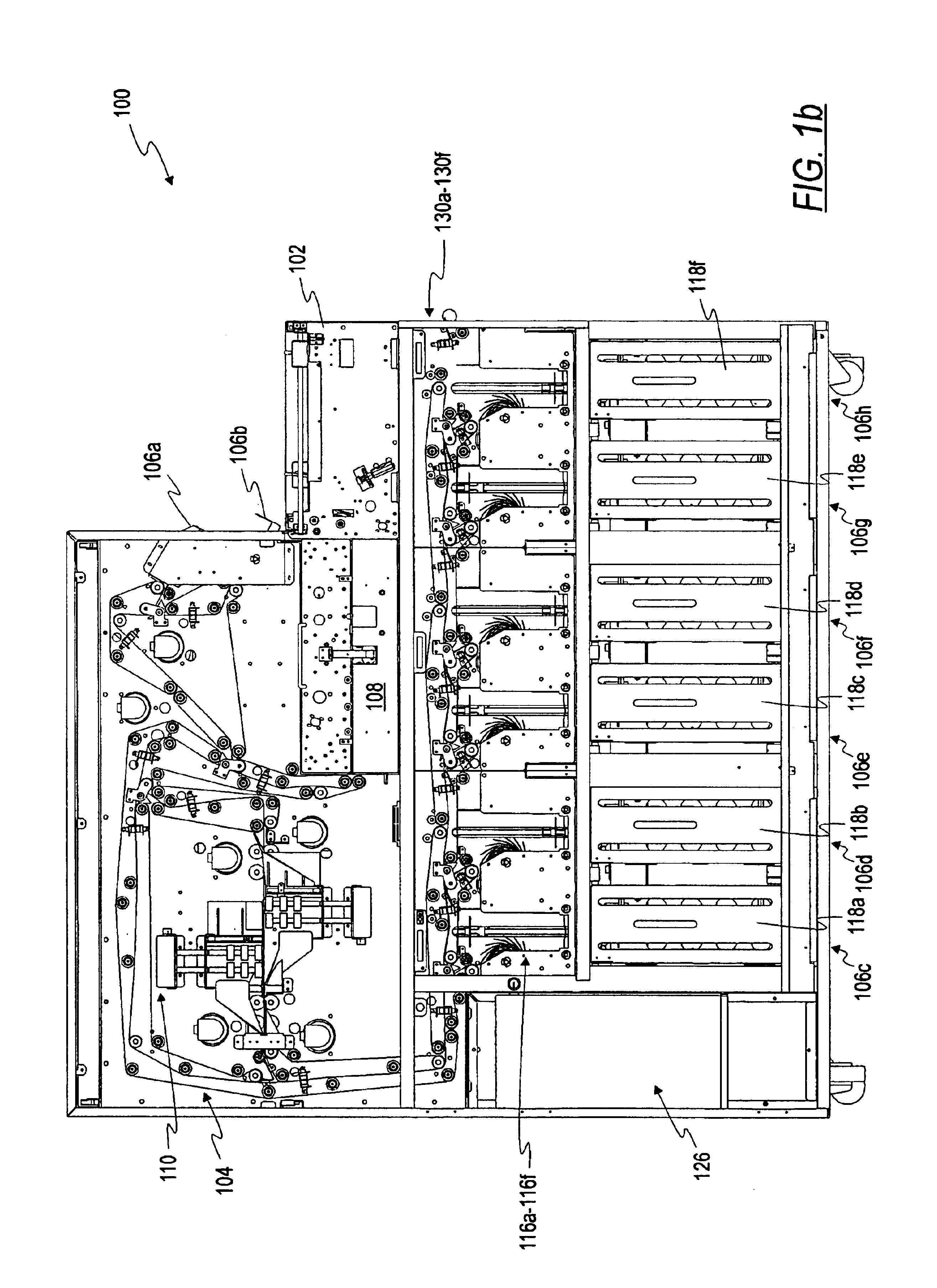

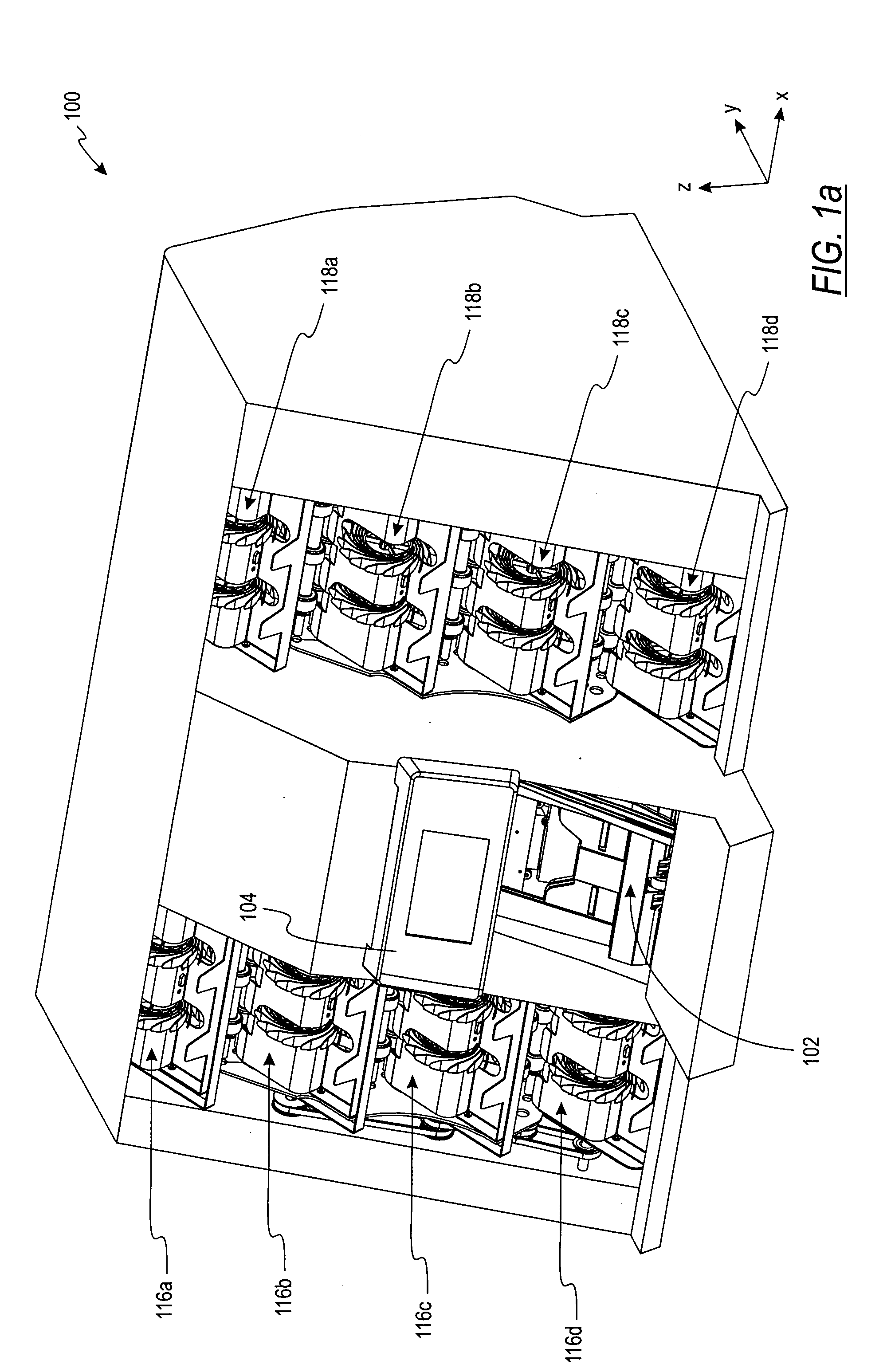

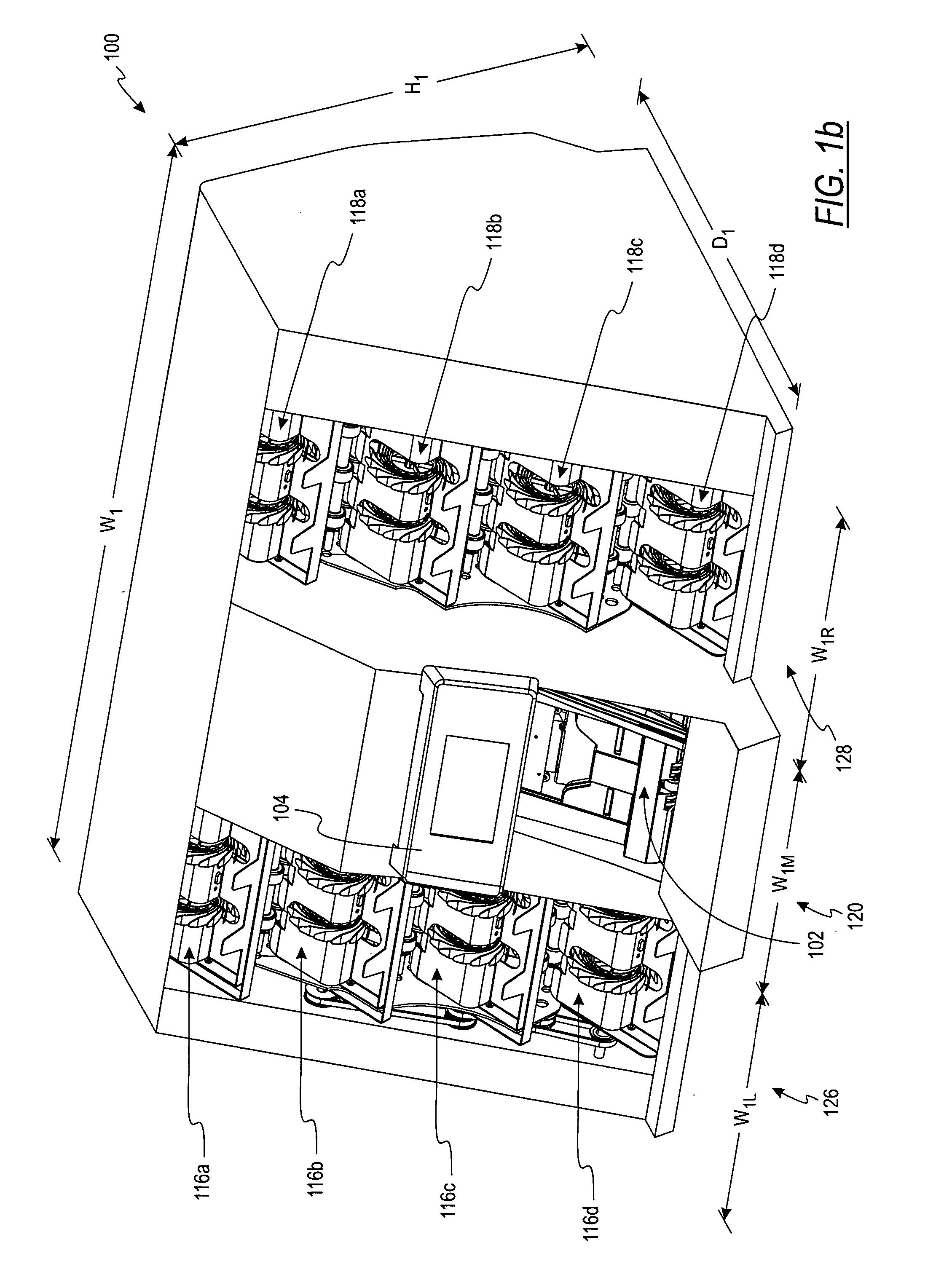

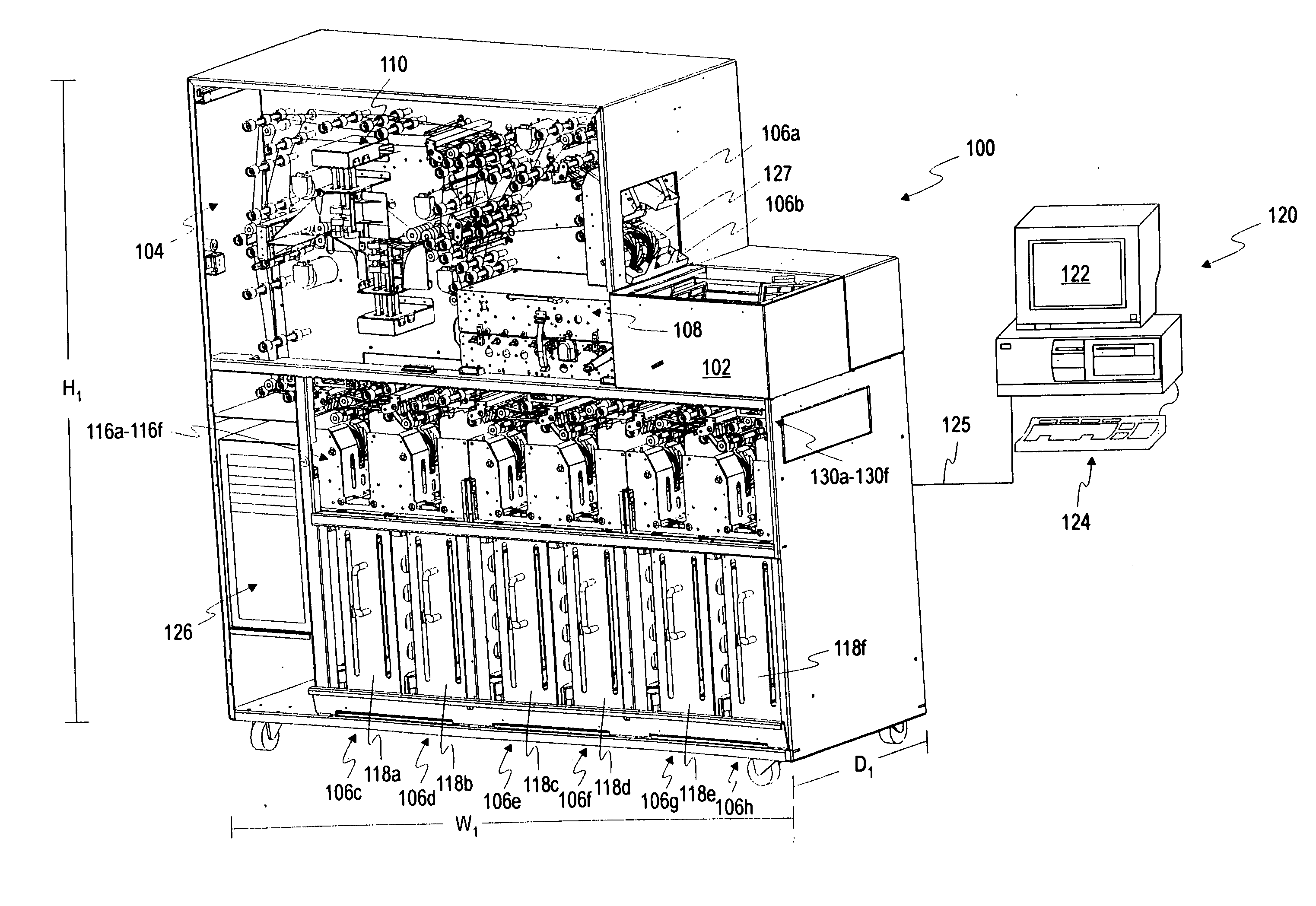

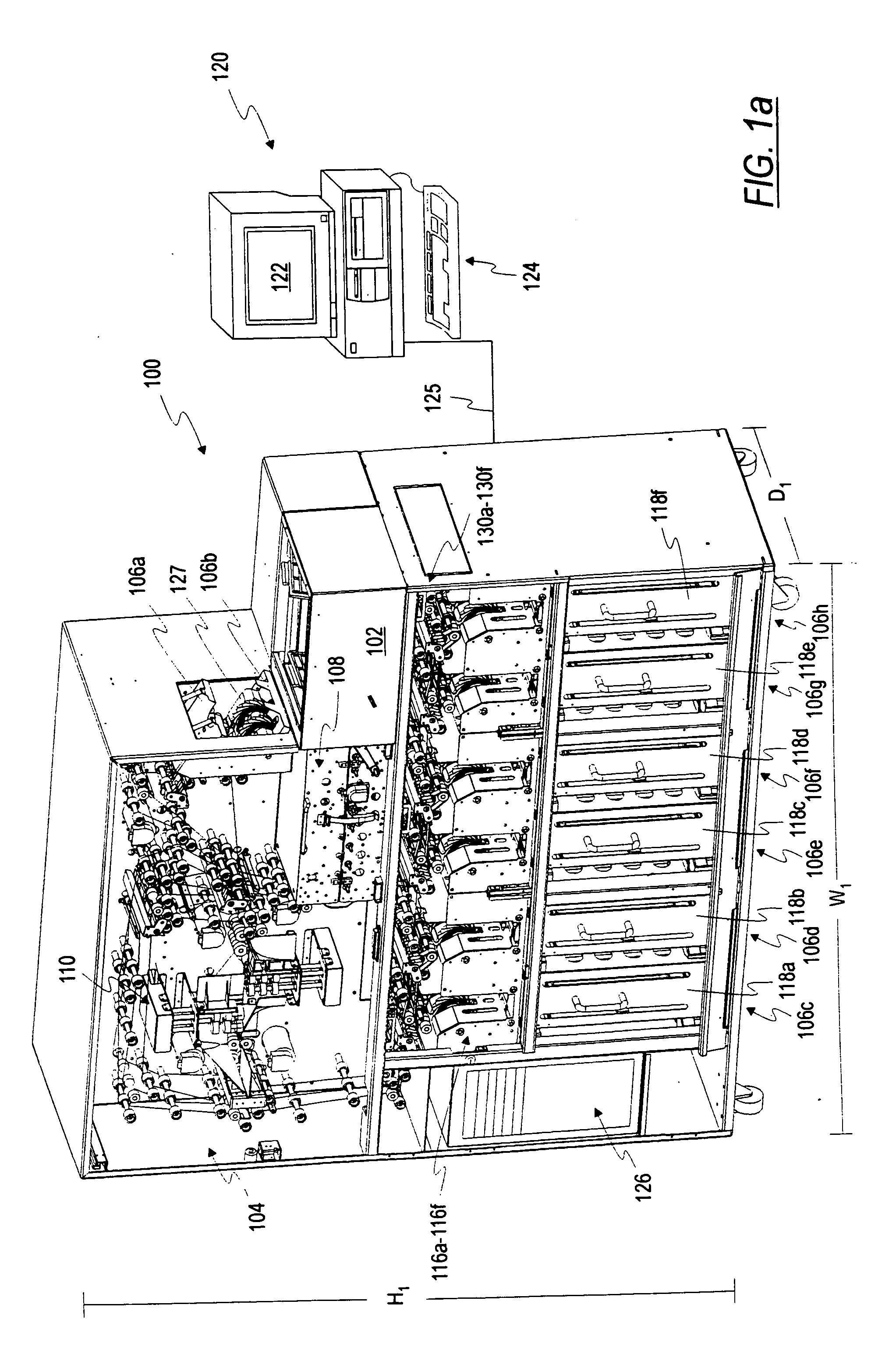

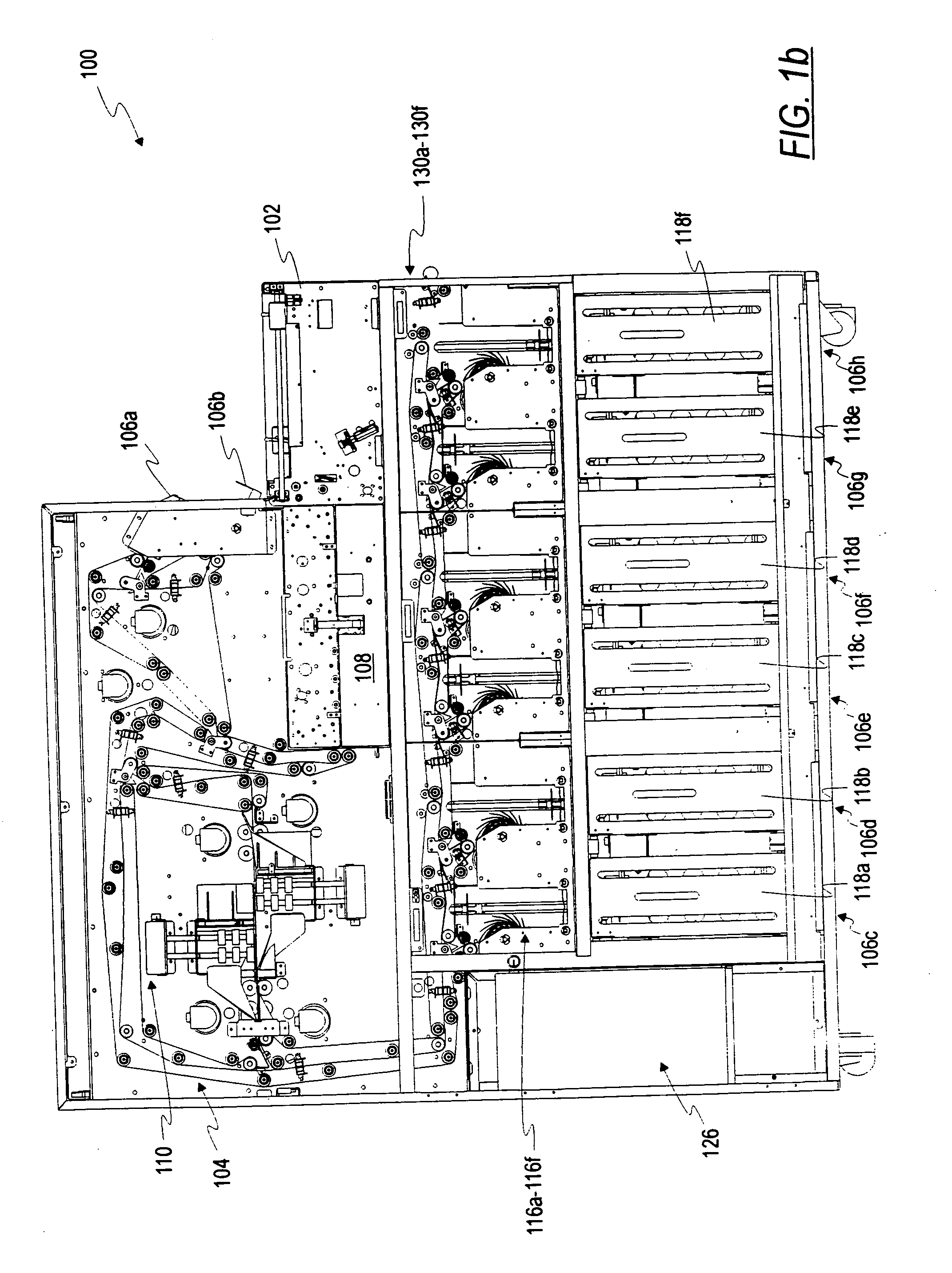

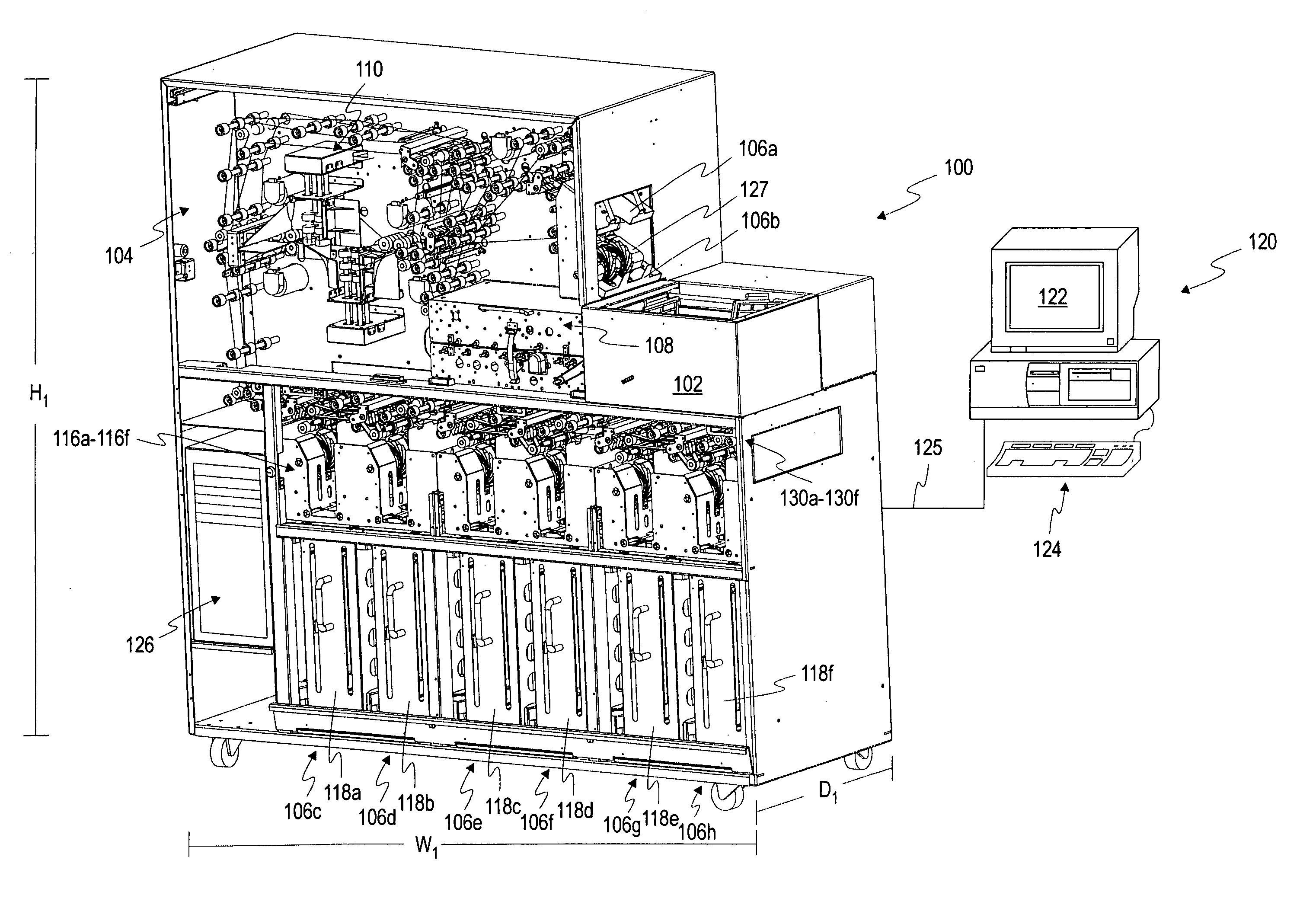

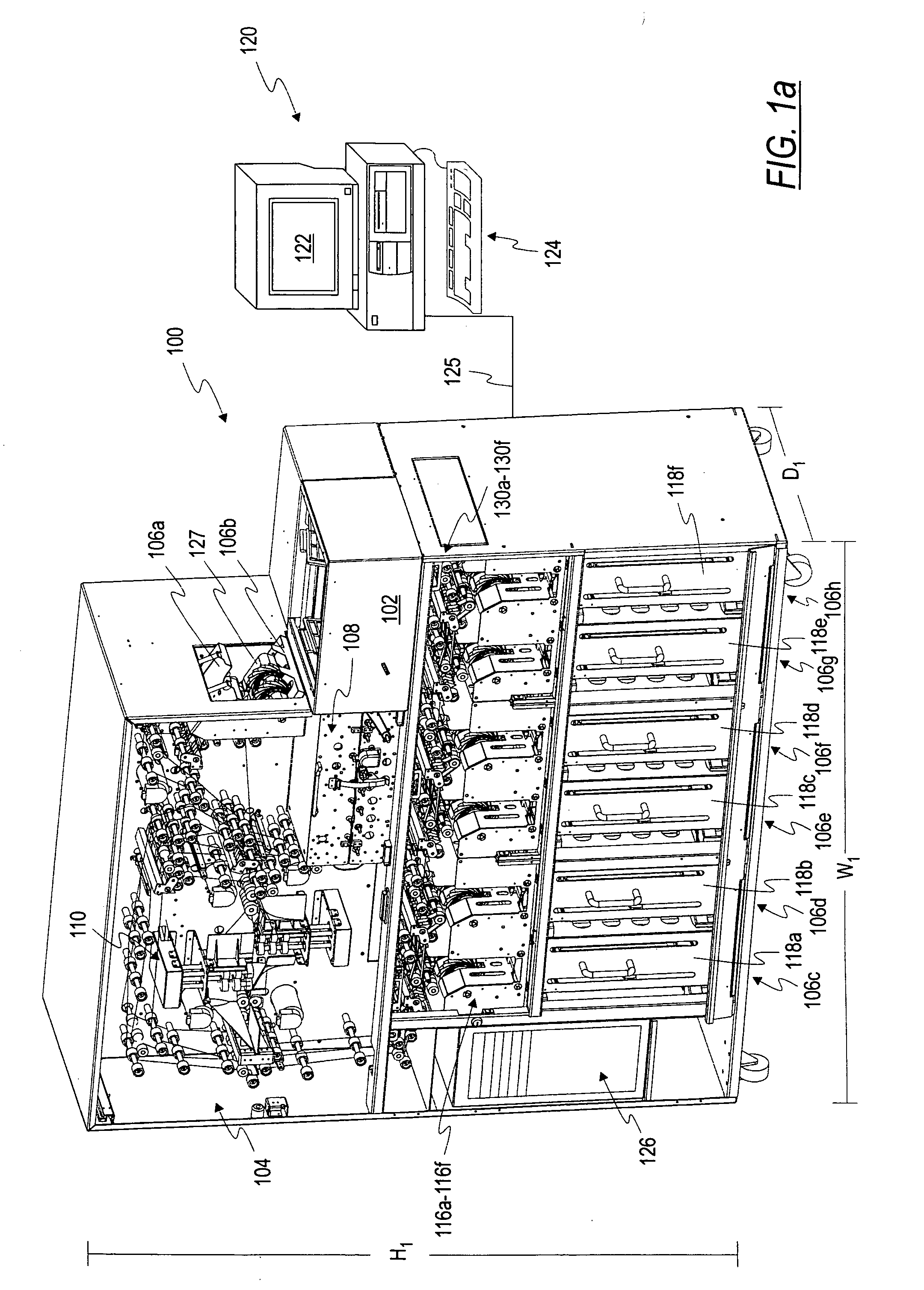

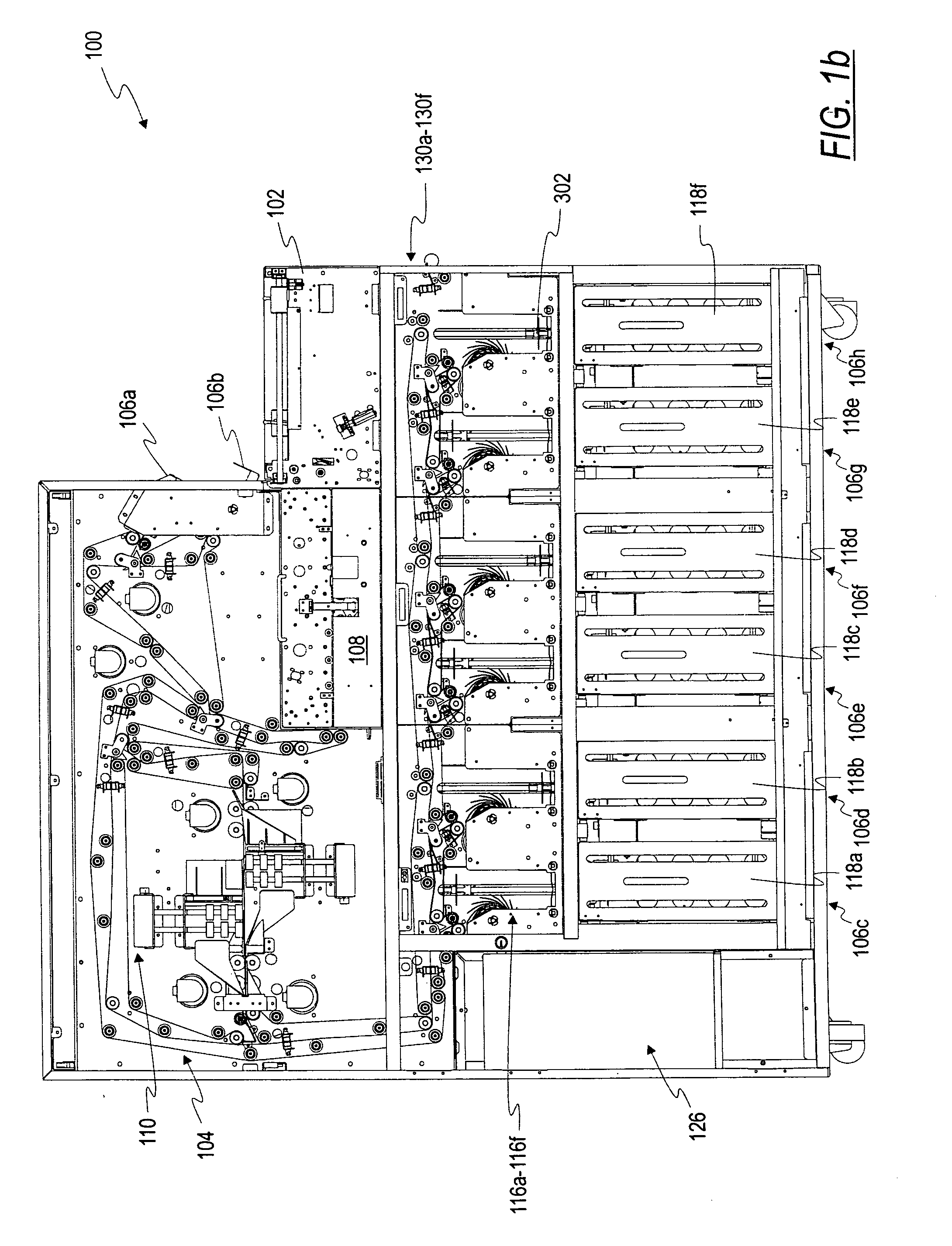

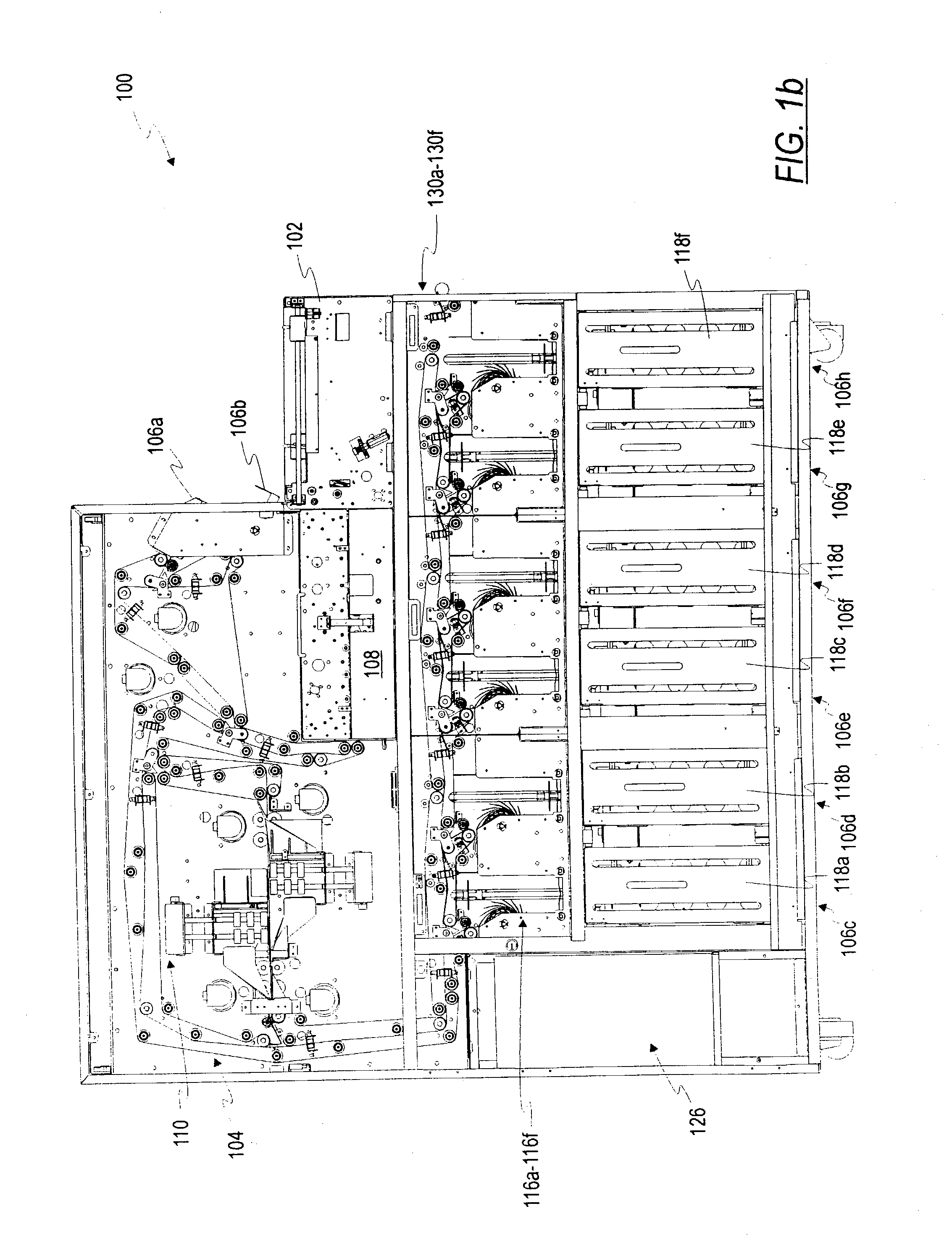

Multiple pocket currency bill processing device and method

Owner:CUMMINS-ALLISON CORP

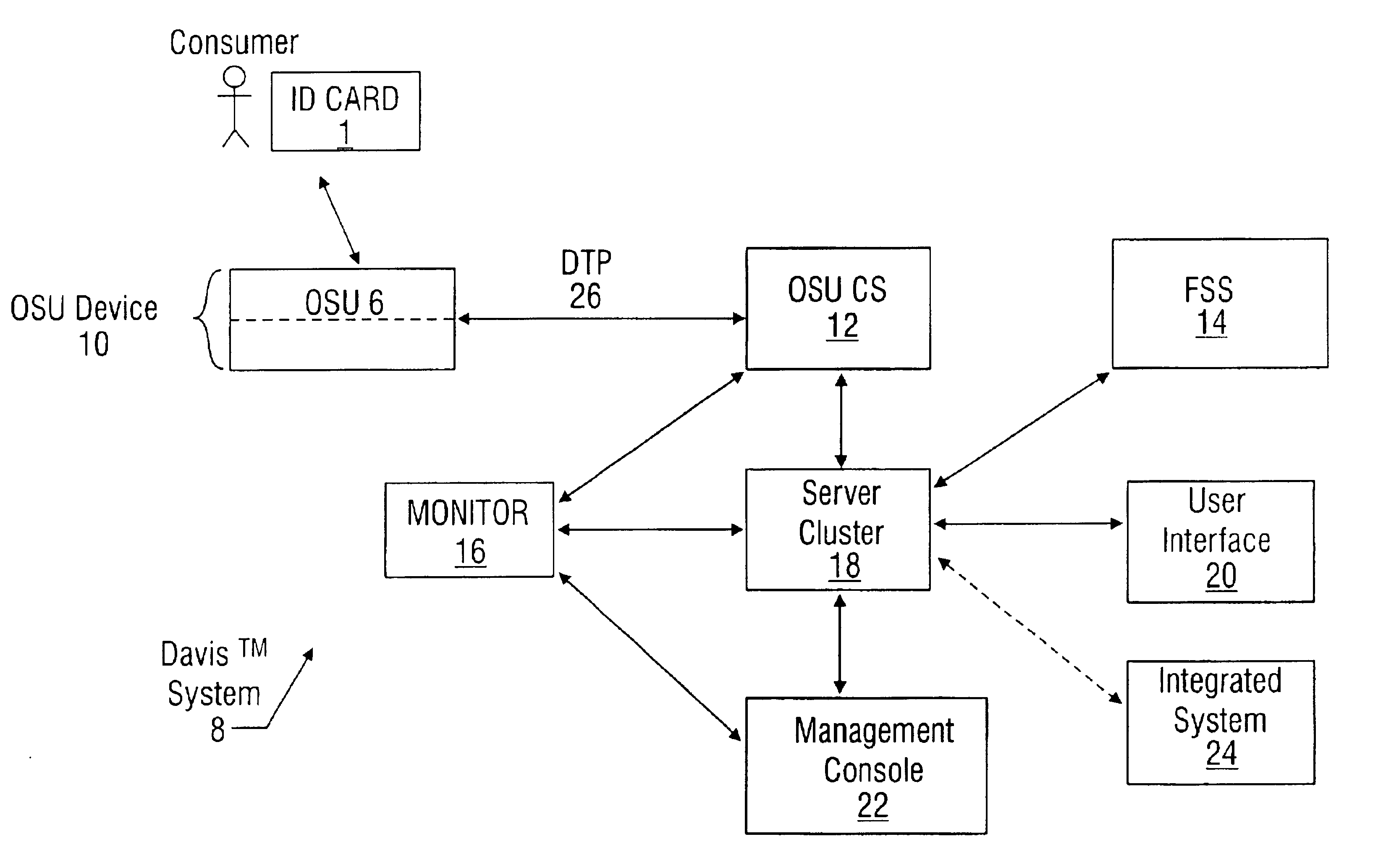

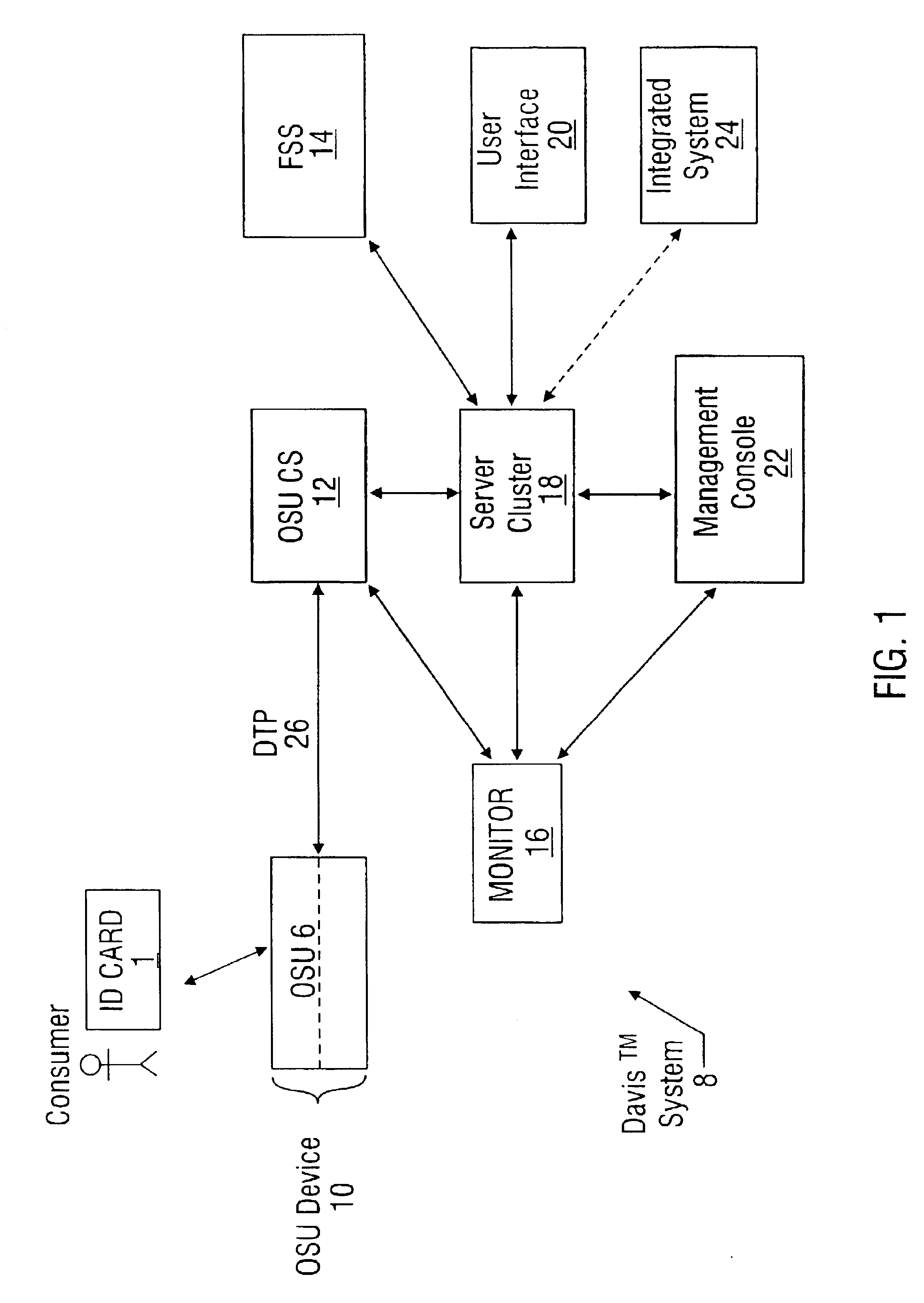

System for vending products and services using an identification card and associated methods

InactiveUS6854642B2Improve system performanceEasy to analyzeSpecial data processing applicationsVerifying markings correctnessComputer terminalDriver's license

A highly integrated and flexible system for vending products and services to consumers. The system receives information in advance of the vend by having the consumer insert an identification (ID) card, preferably a driver's license, into a point-of-purchase terminal (referred to as an OSU device). The OSU device preferably contains an Optical Scanning Unit (OSU), capable of scanning the textual information on the ID card. In one embodiment, the scanned information is compared against optical templates present in the system to discern or verify the information on the ID card, and is then used by the system to enable or disable the vending transaction, and / or to allow access to several preregistered system accounts.

Owner:CNT TECH

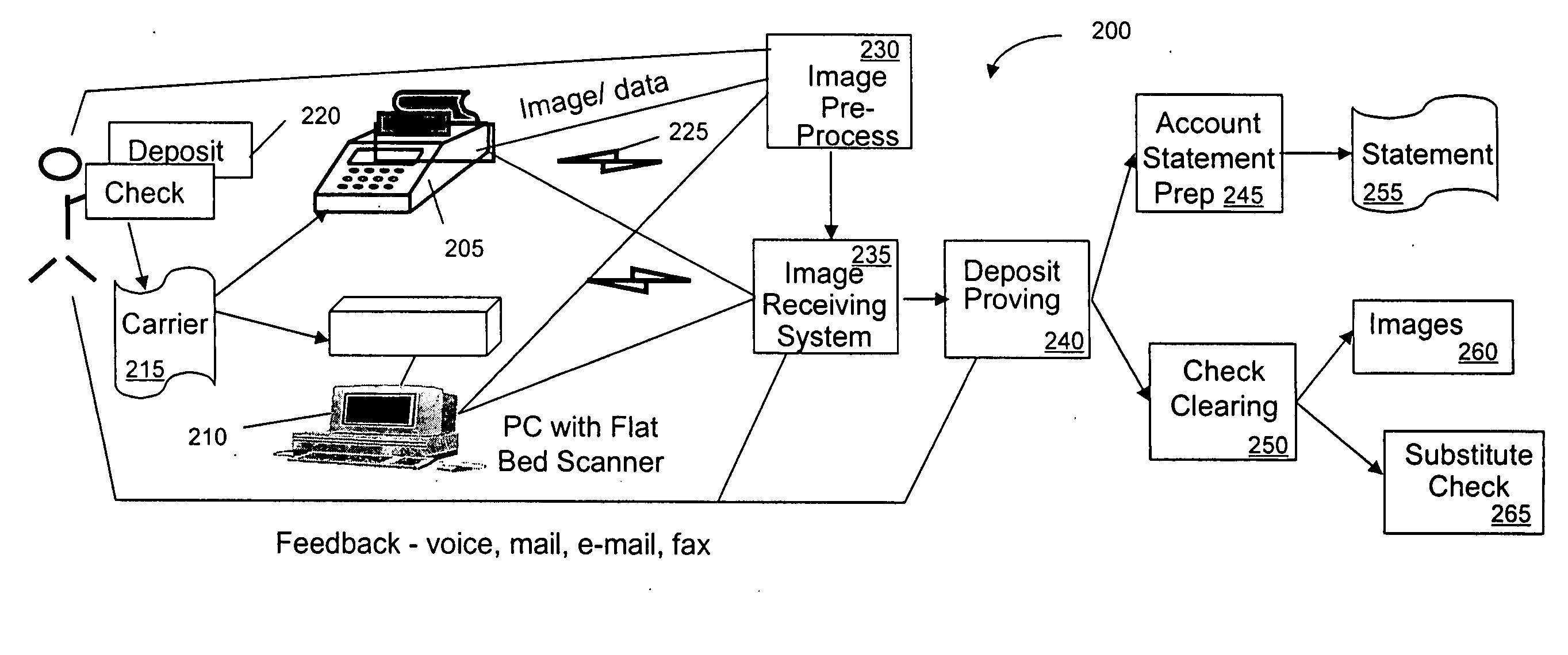

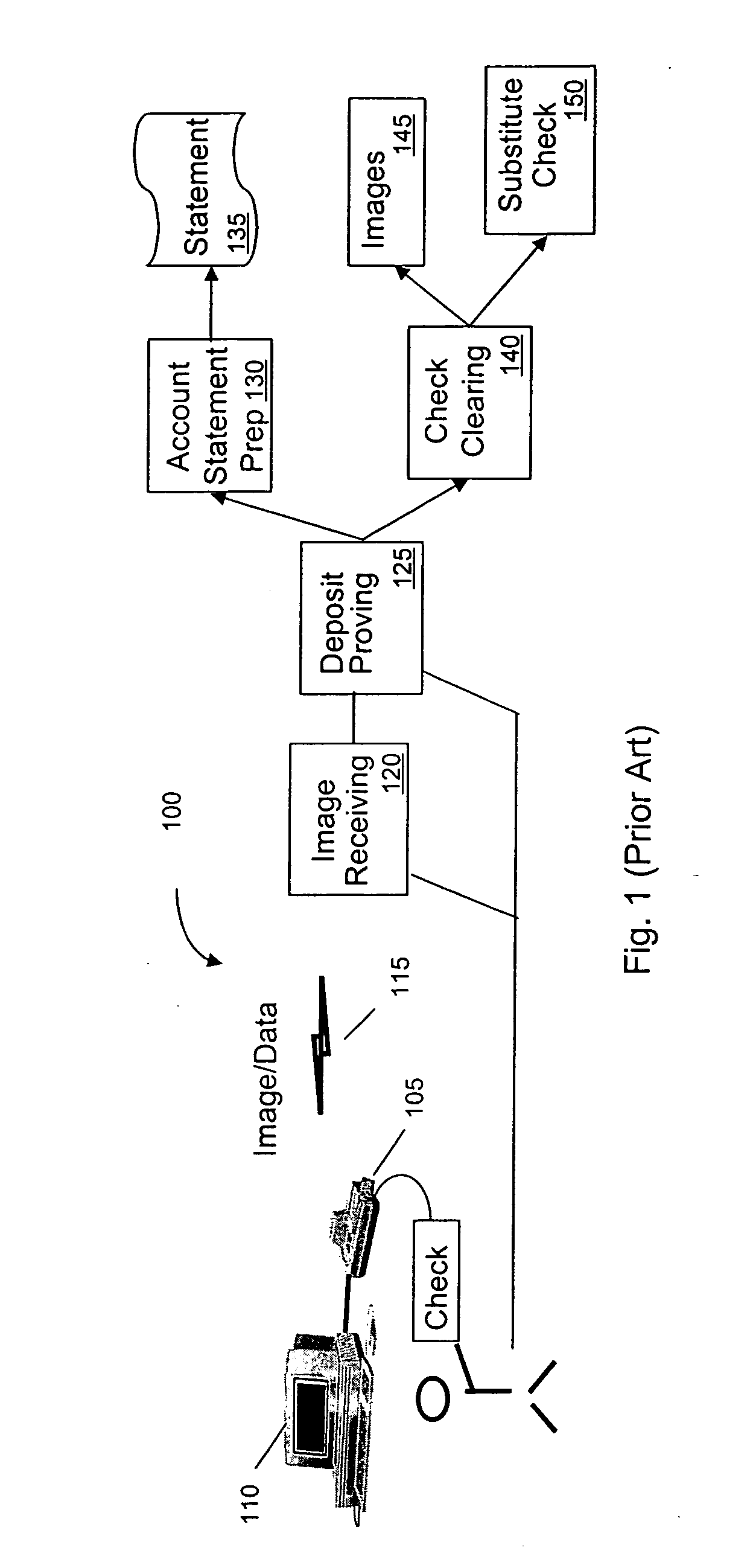

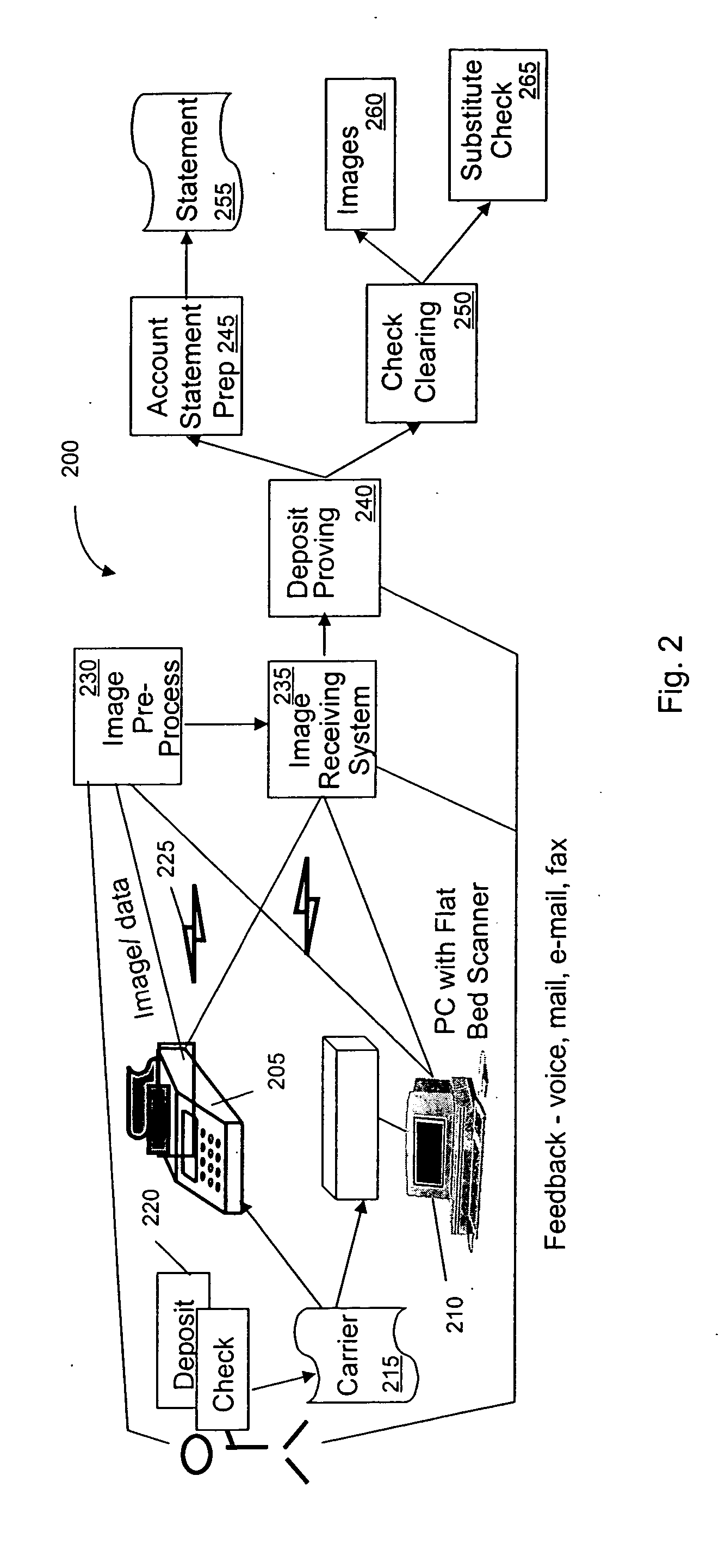

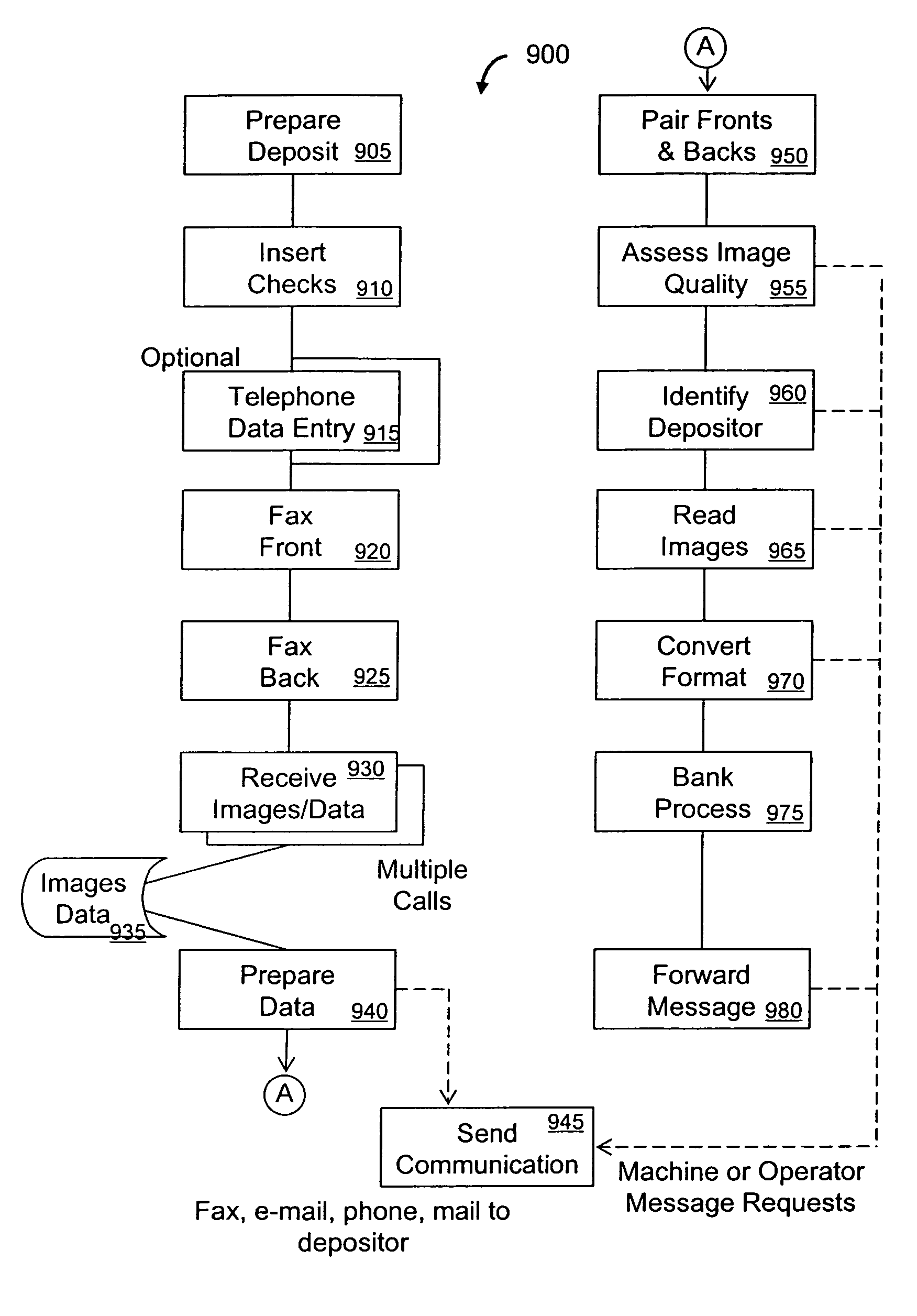

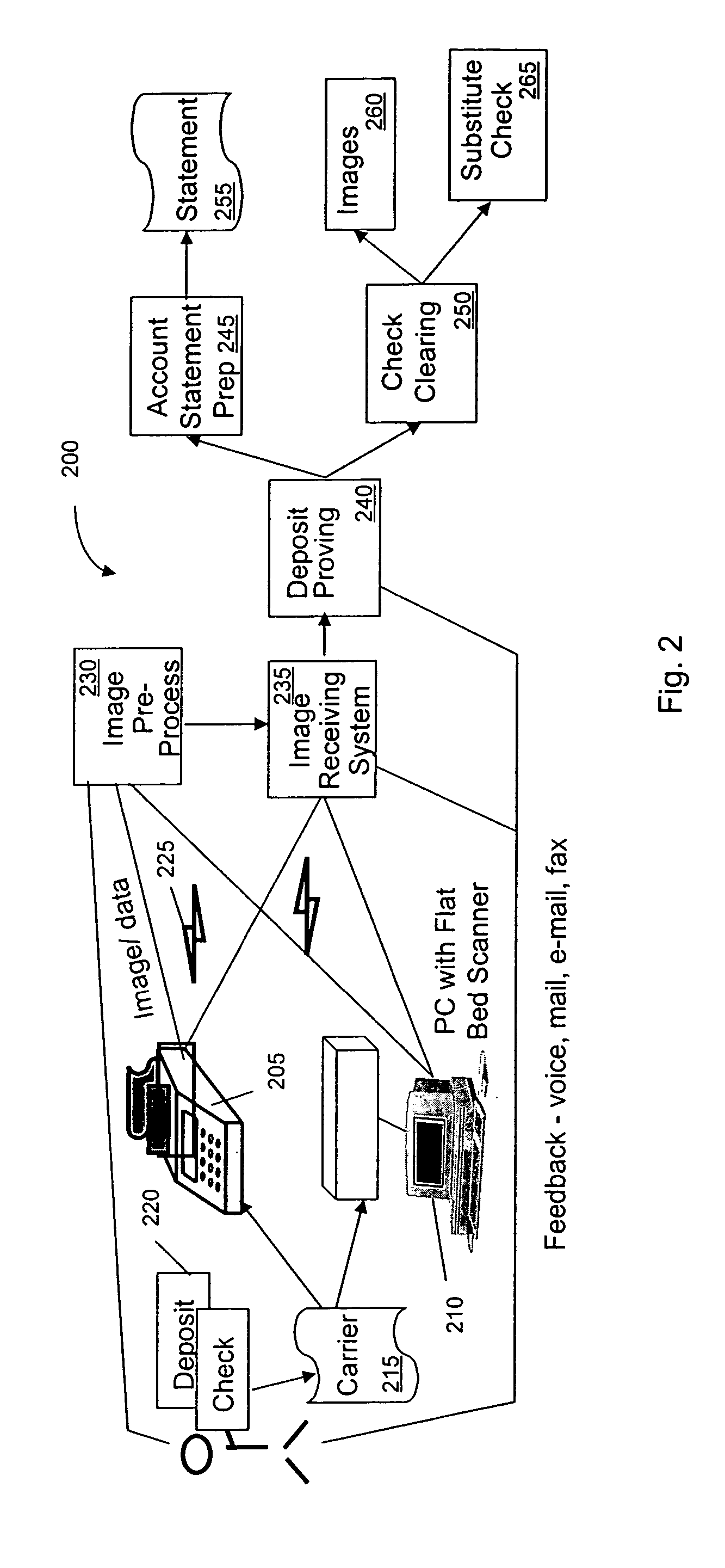

Ubiquitous imaging device based check image capture

A method or corresponding apparatus for remote transmission of a negotiable instrument. In an example embodiment, the process provides a carrier that secures a negotiable instrument. Next, the process creates a unique identifier, associated with the carrier, and generates an electronic image of the negotiable instrument. After generating the electronic image, the process transmits the electronic image of the negotiable instrument and the unique identifier to a remote location. The negotiable instrument may be transmitted via a fax, a scanner, a device designed to transmit electronic data, other image device compatible with ITU-T recommendations T.30 or T.4, or combination thereof. The process may also verify the negotiable instrument has a valid endorsement, verify image quality of the electronic image to ensure compliance with financial industry standards, or validate any received security information.

Owner:LIGHTHOUSE CONSULTING GROUP

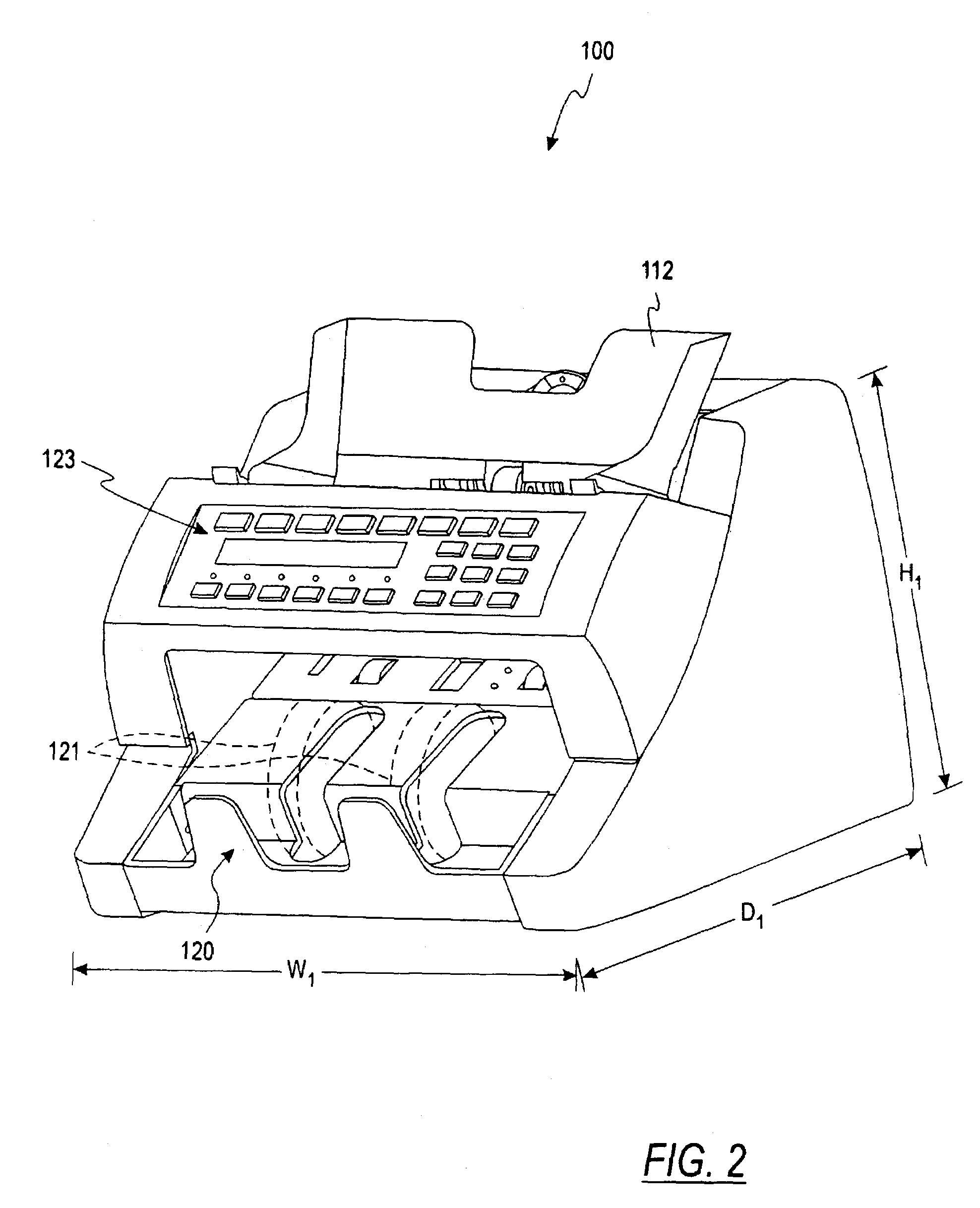

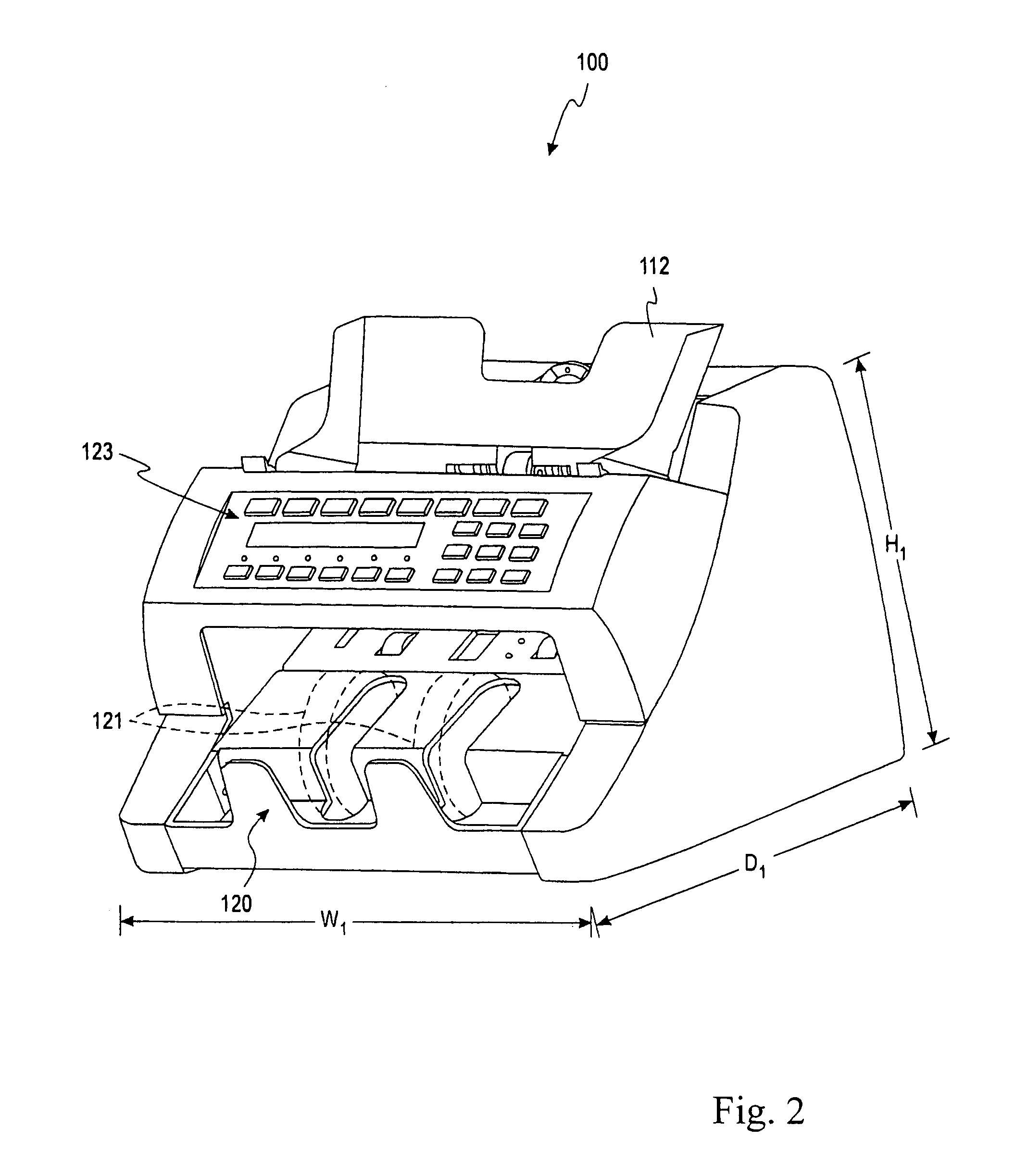

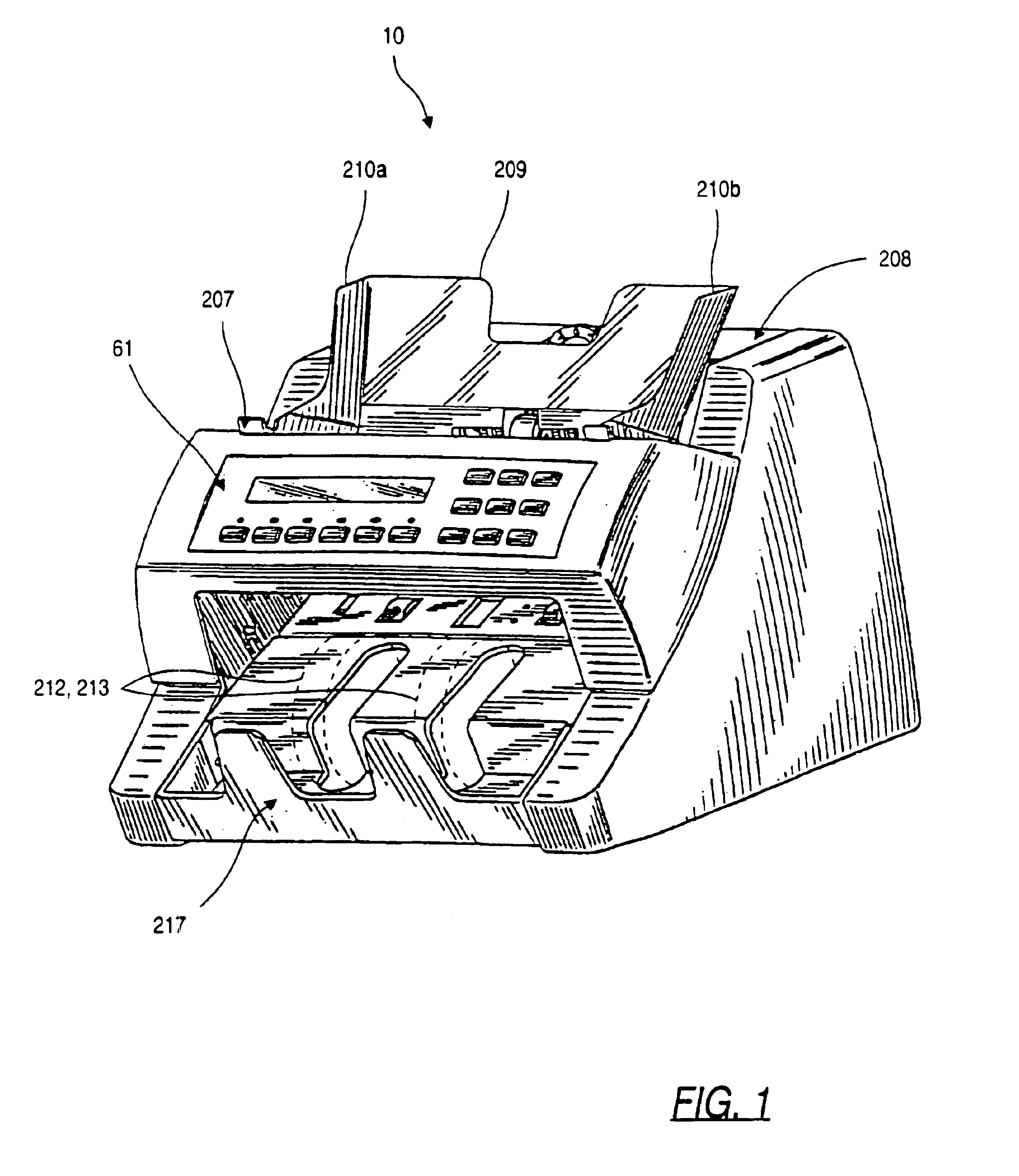

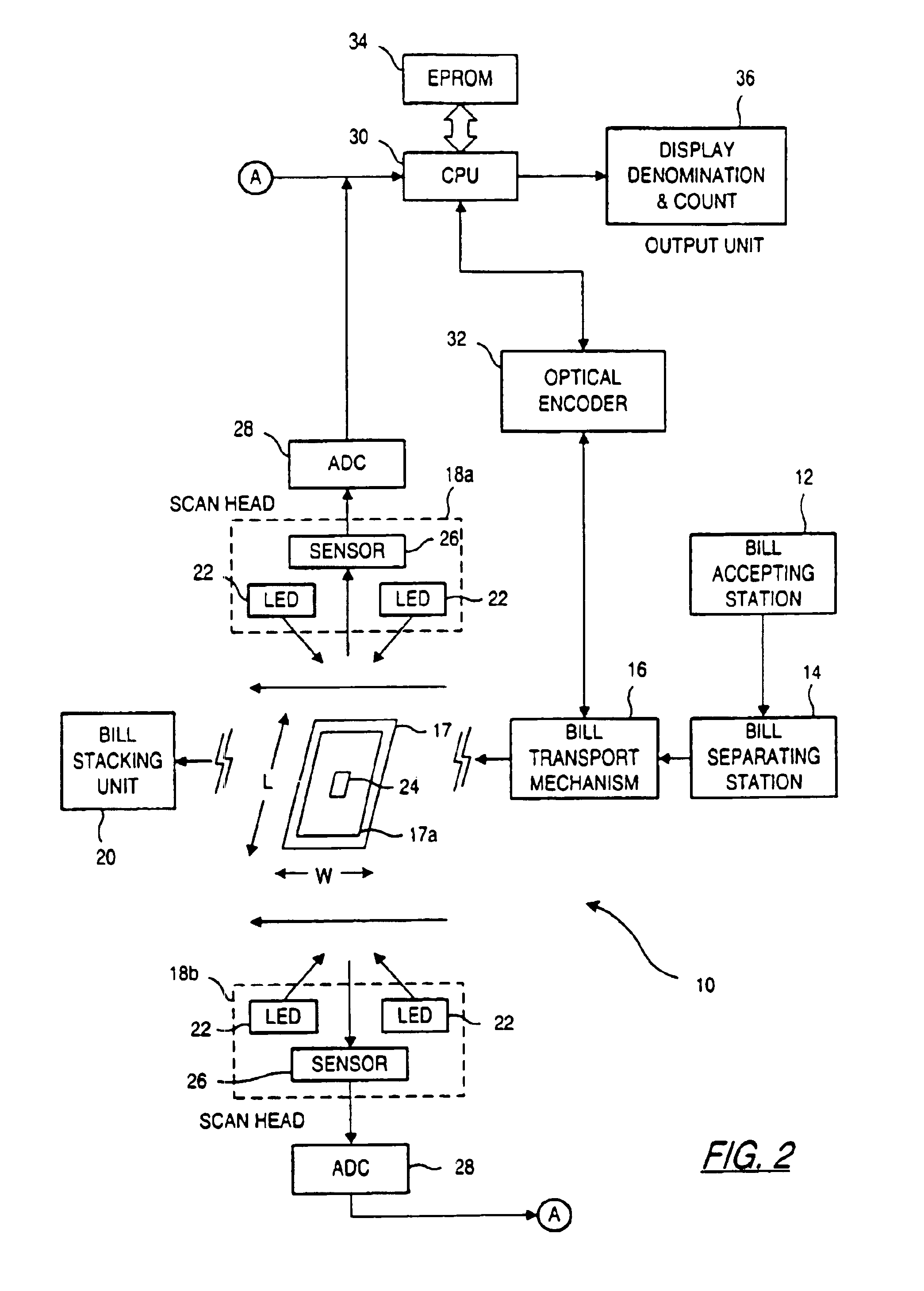

Currency processing device, method and system

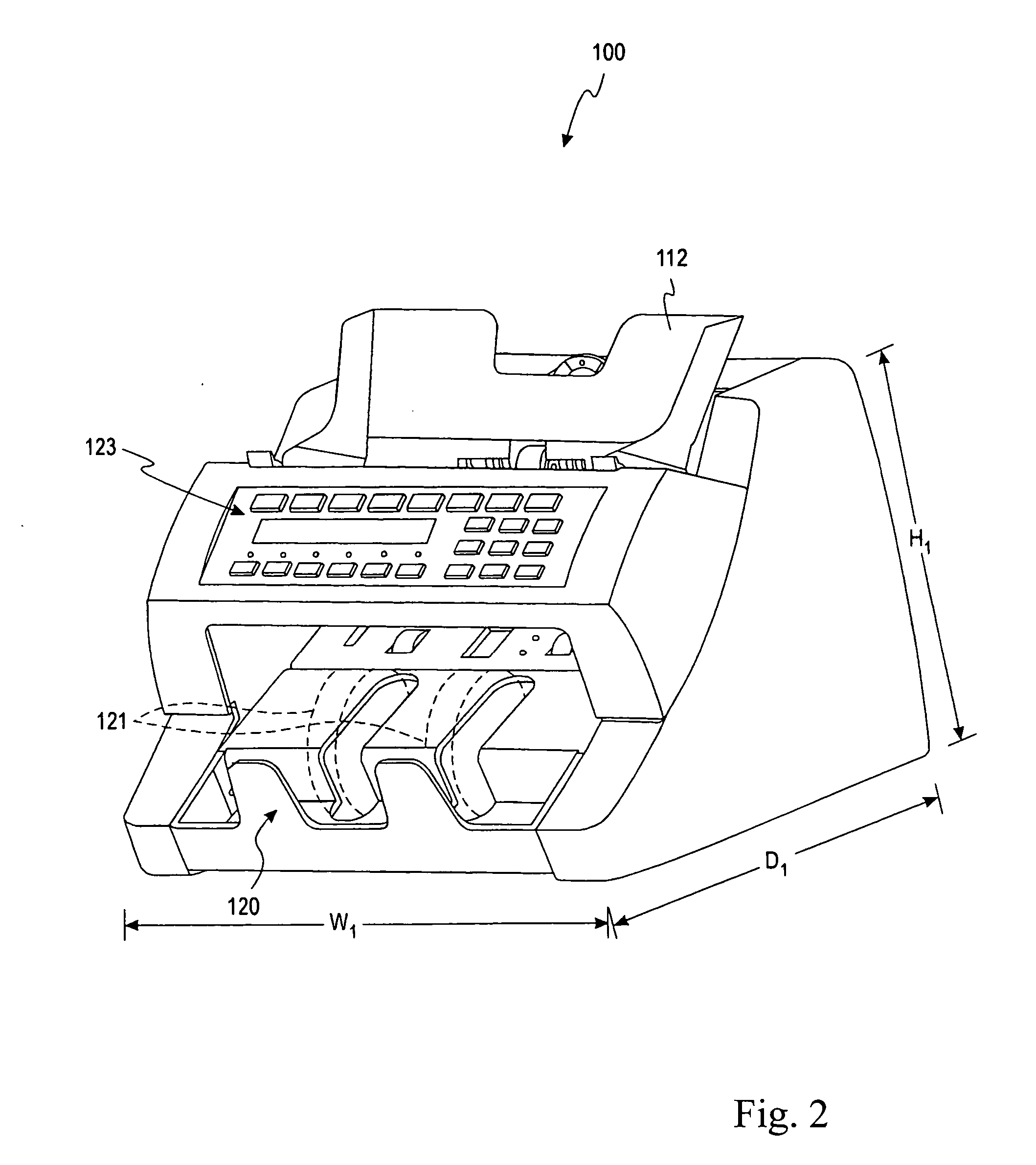

InactiveUS20050029168A1Rapid assessmentClose proximityOverturning articlesCoin/currency accepting devicesEngineering

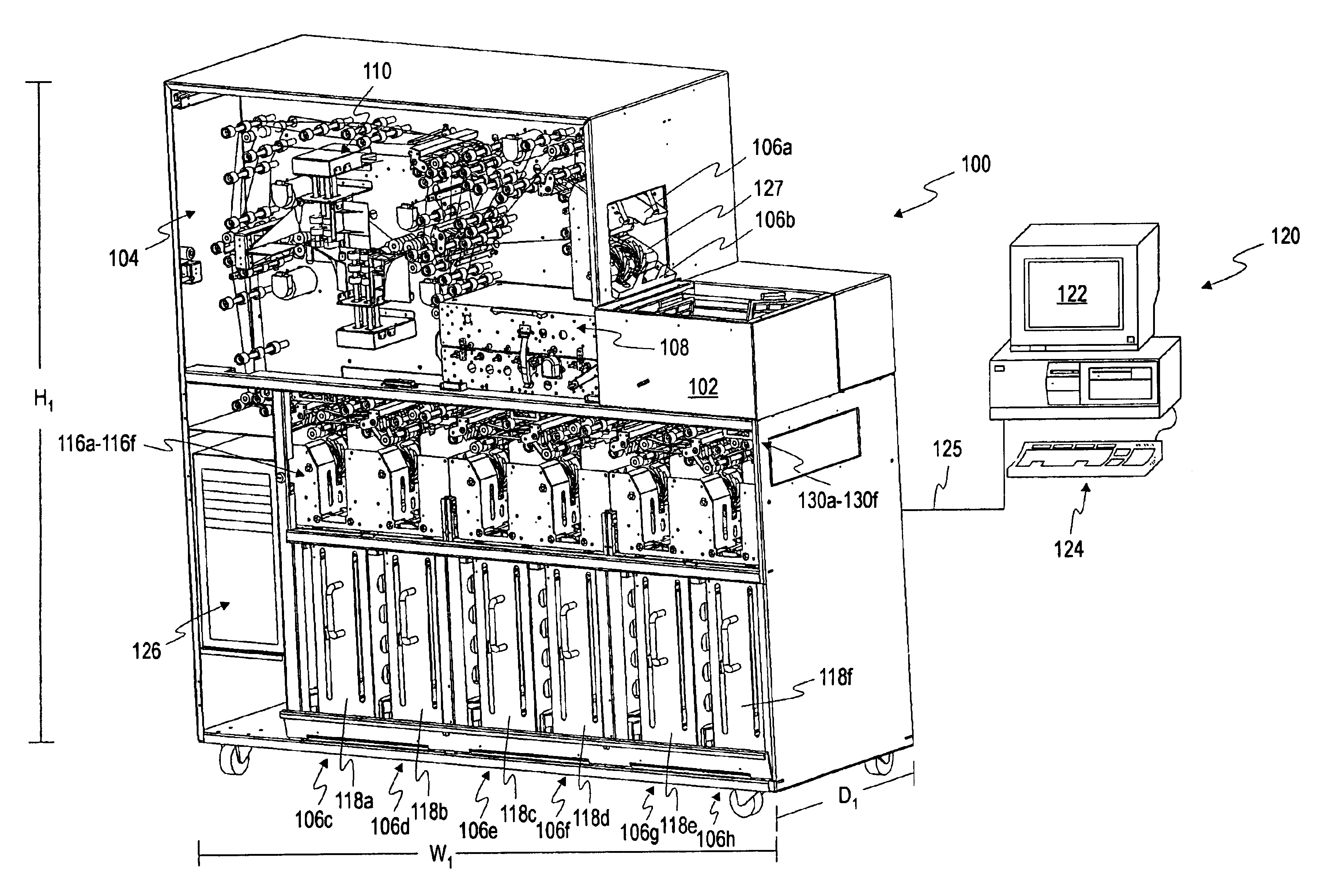

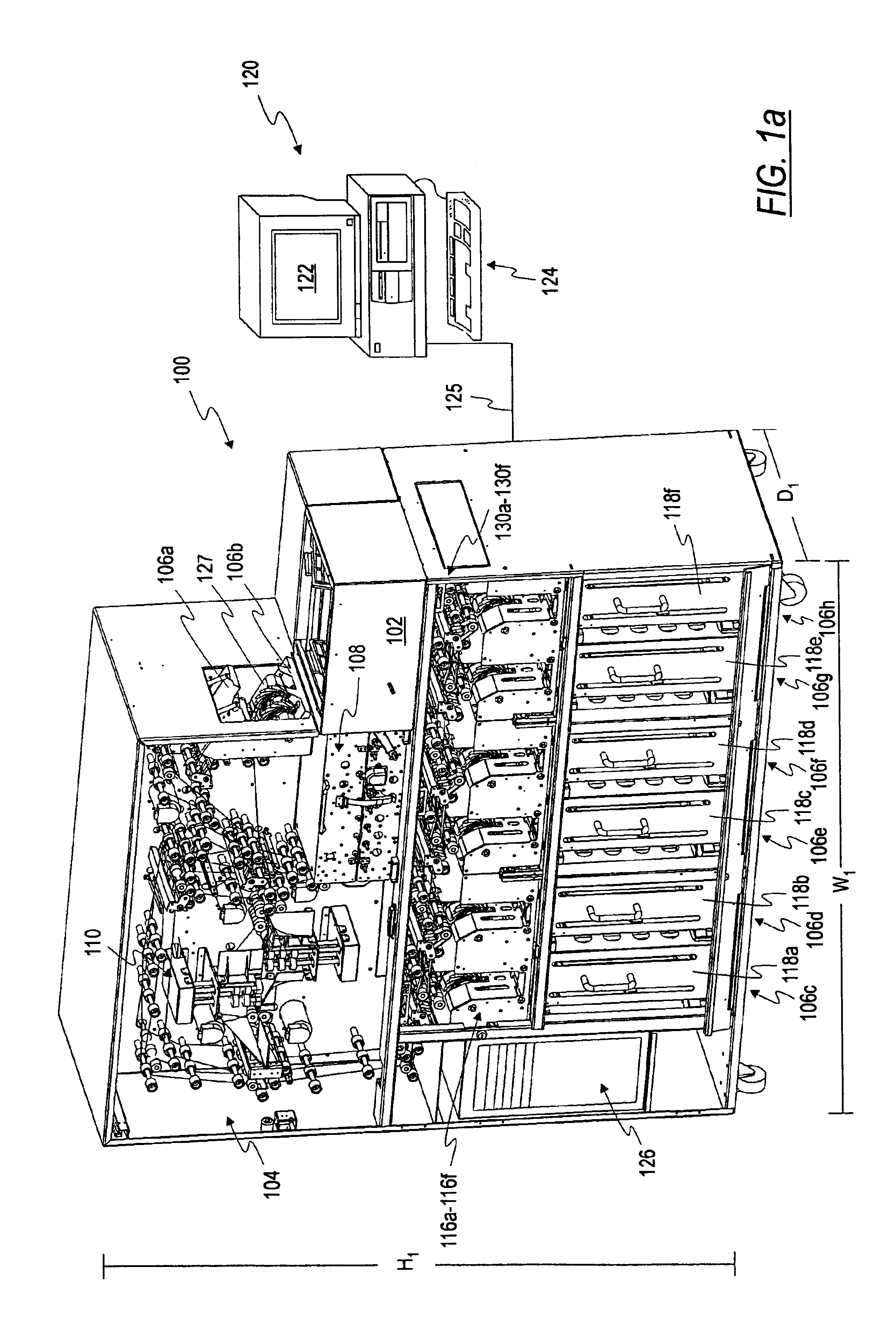

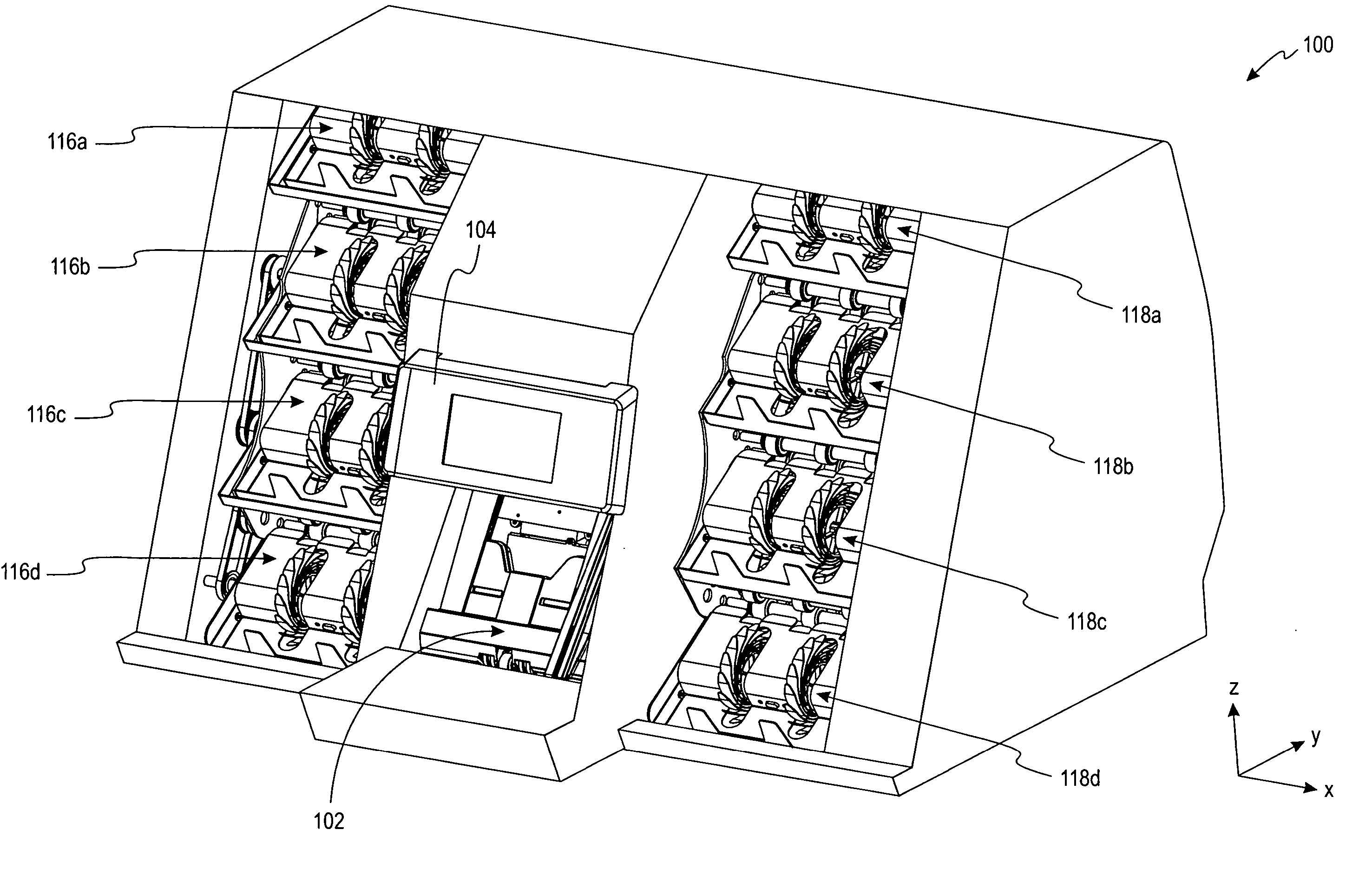

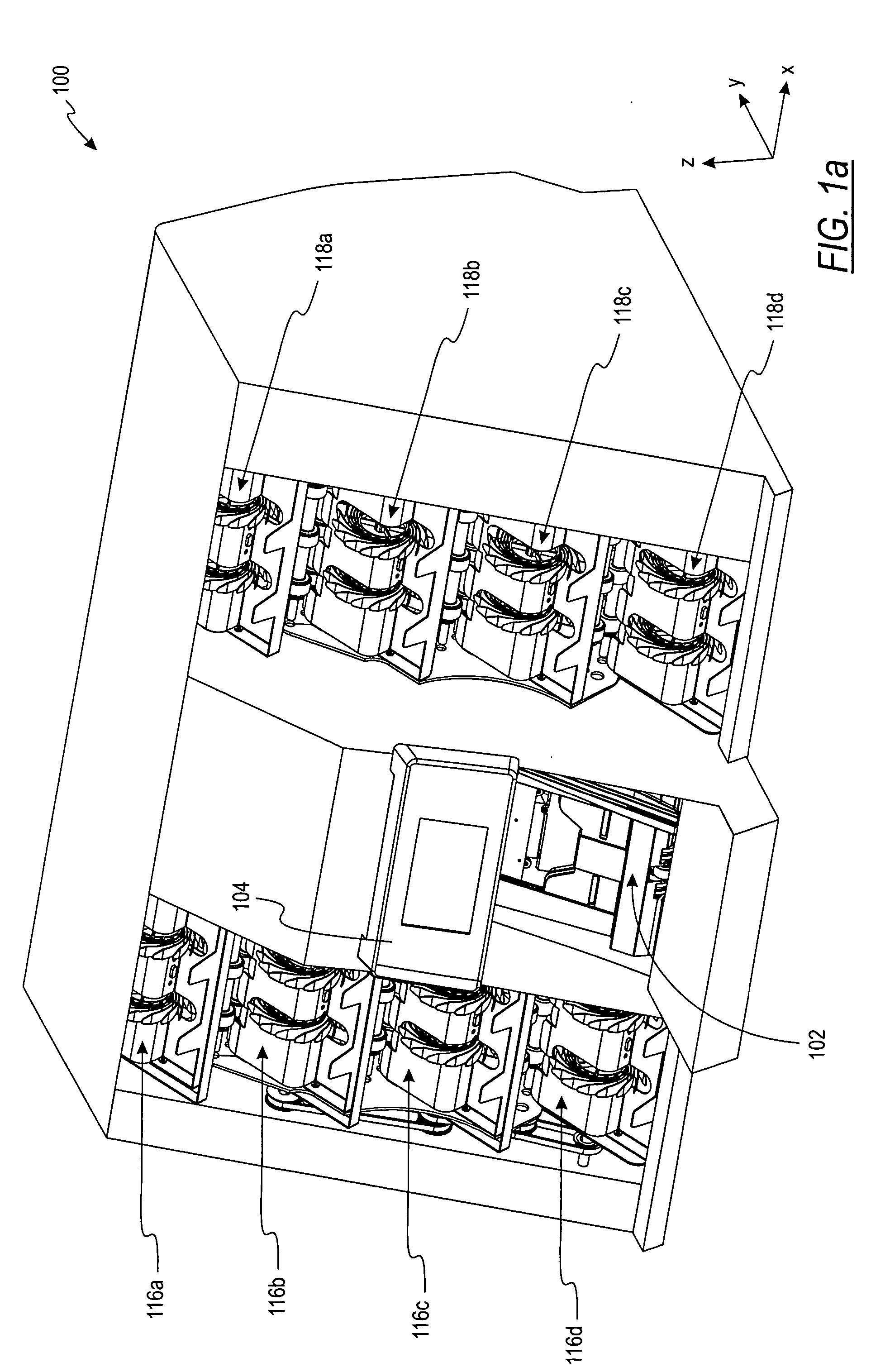

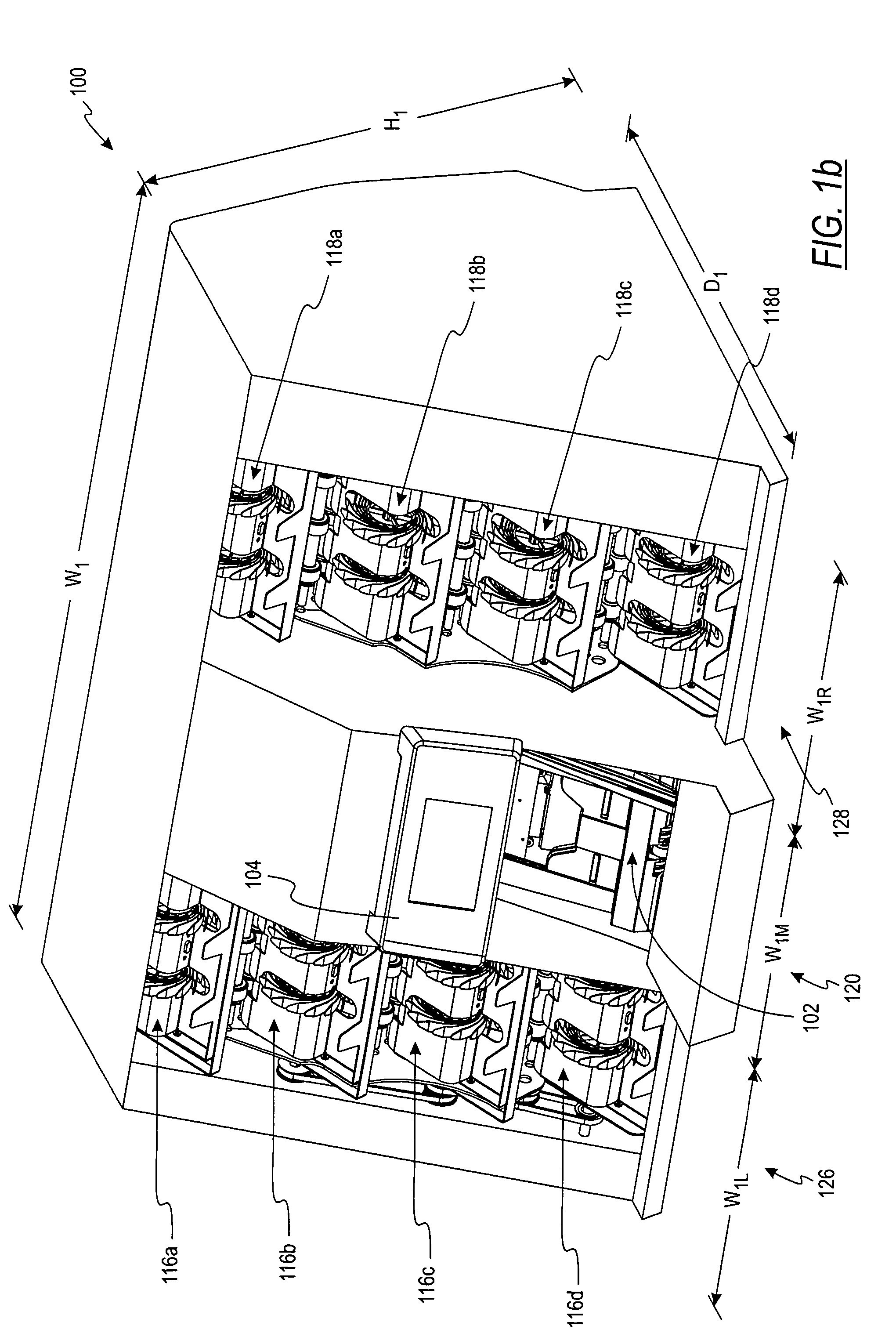

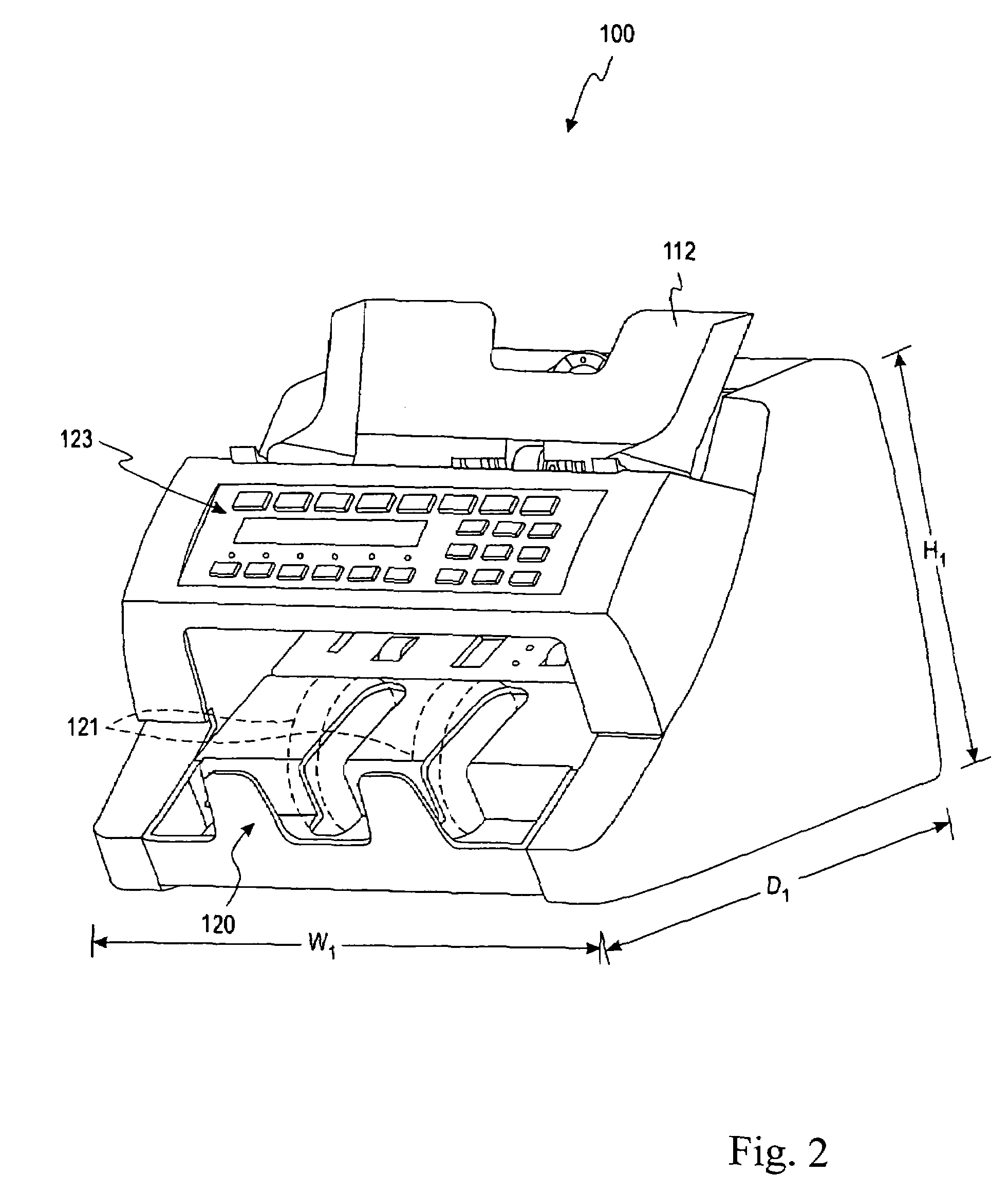

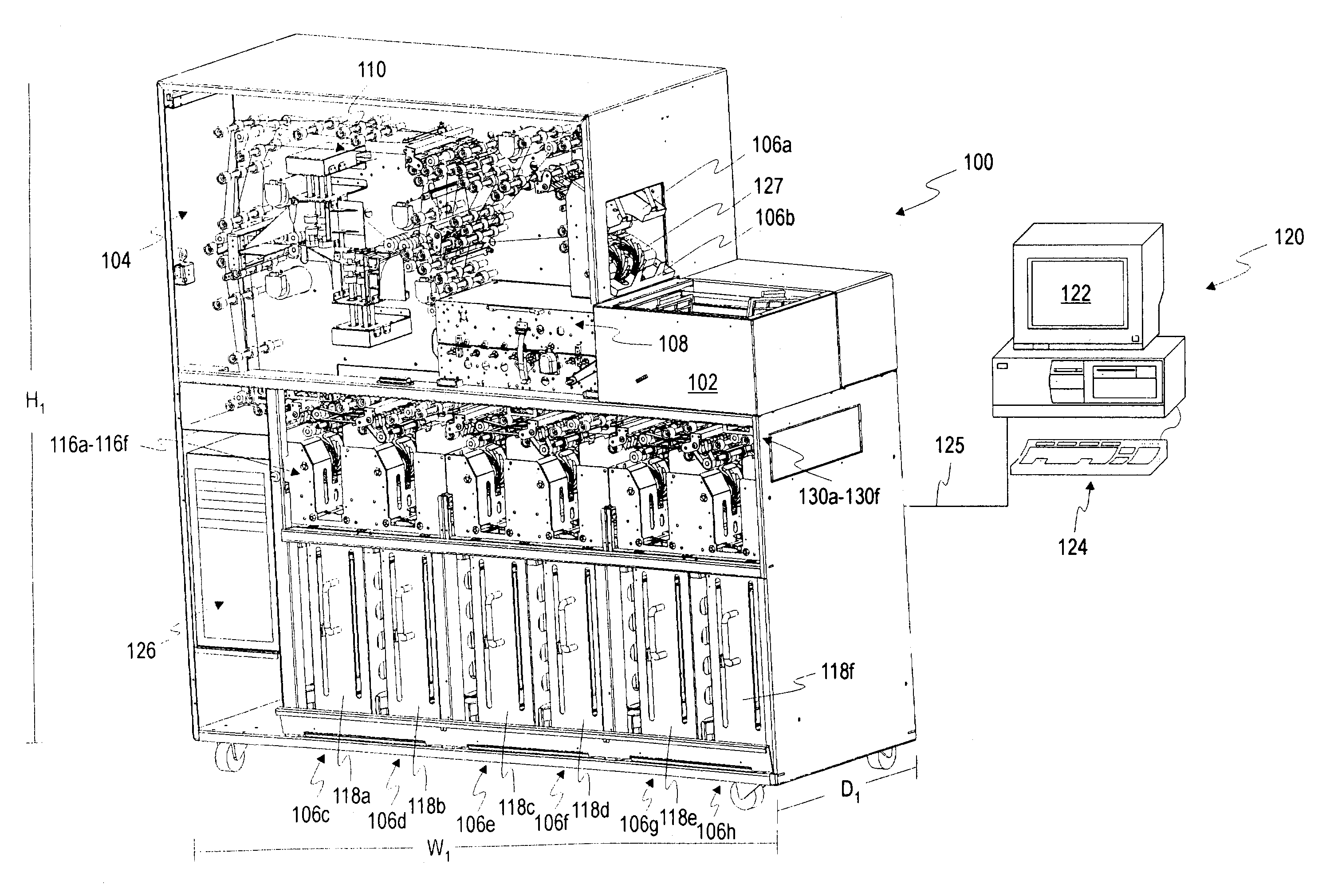

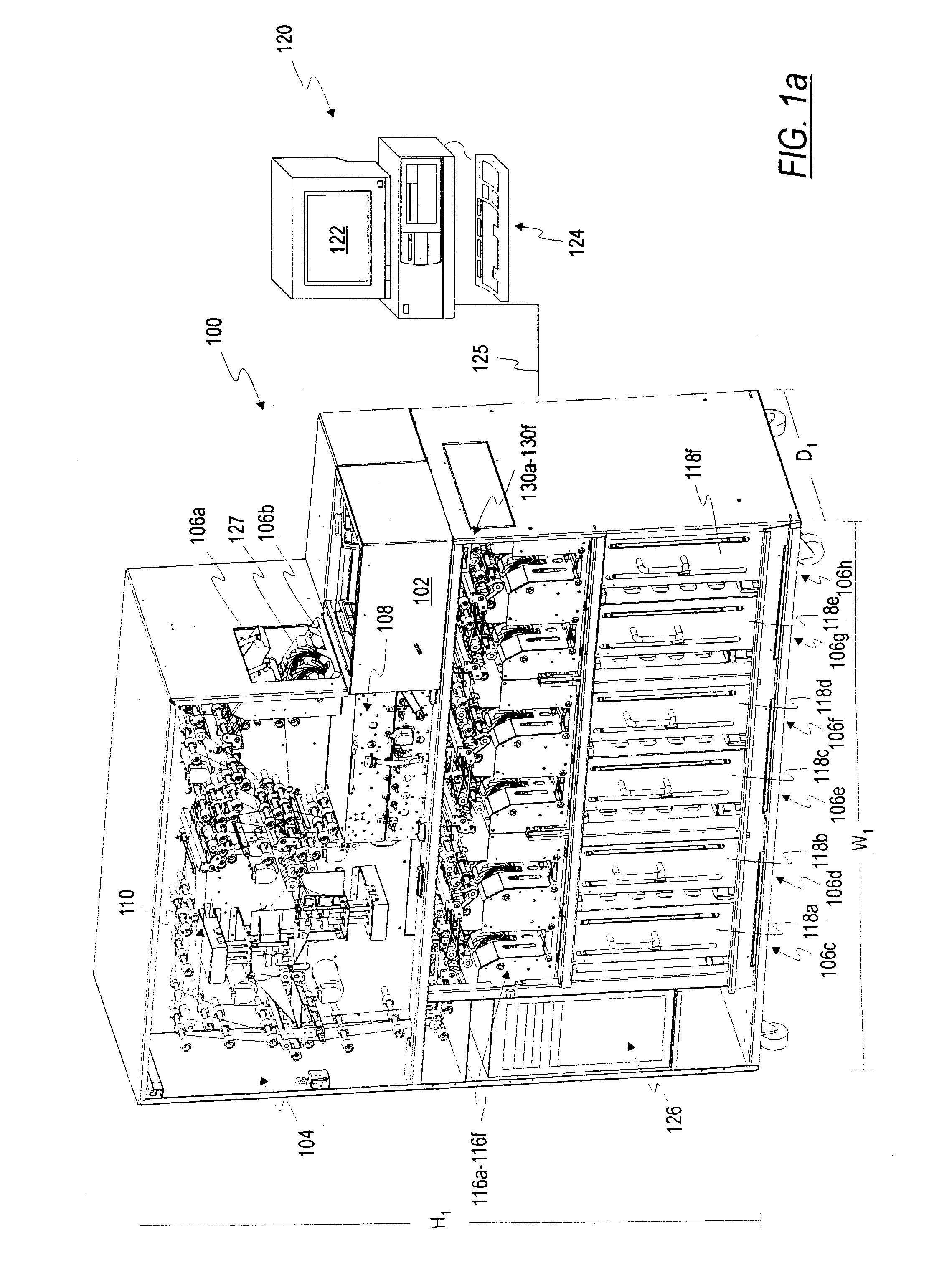

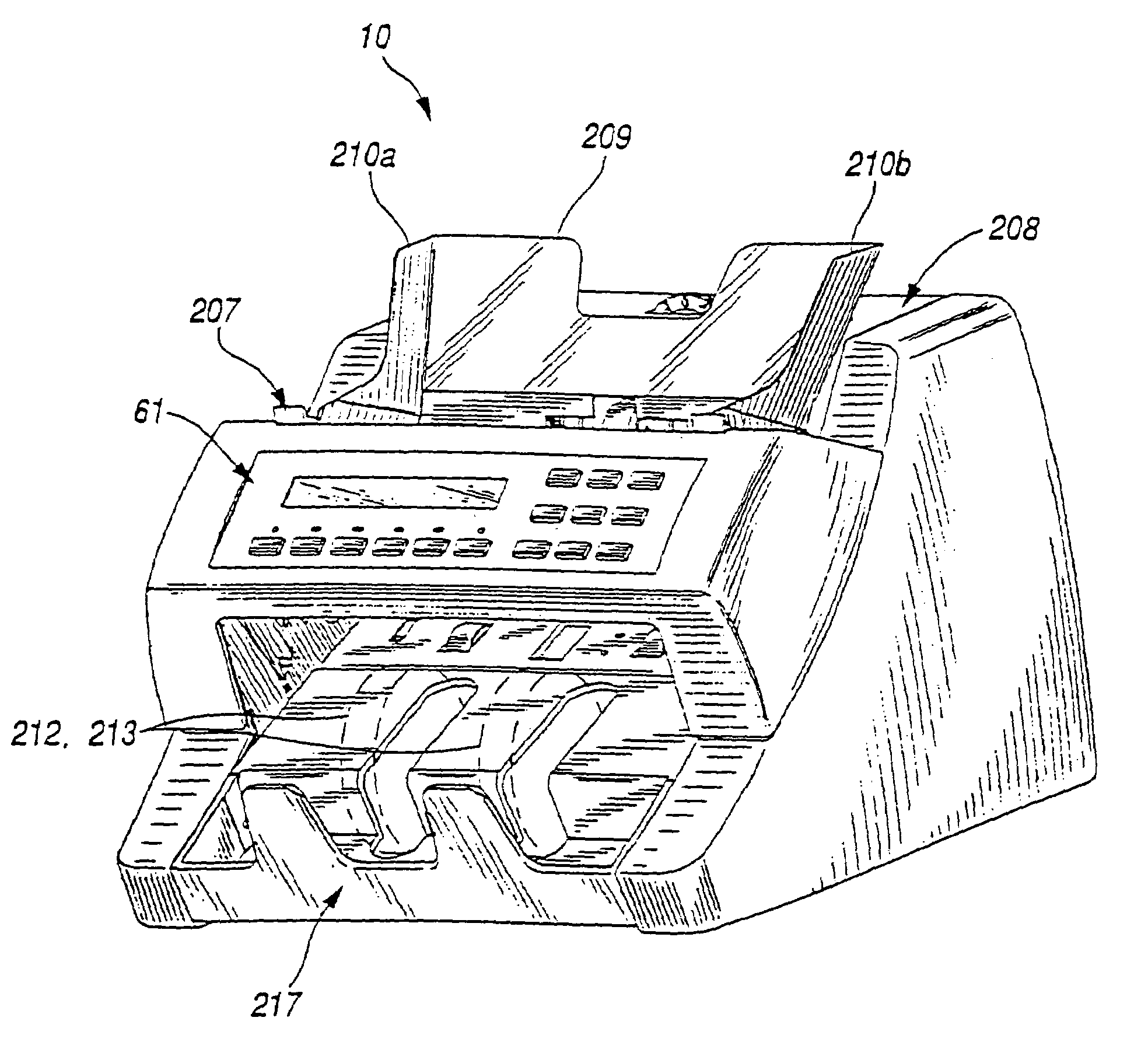

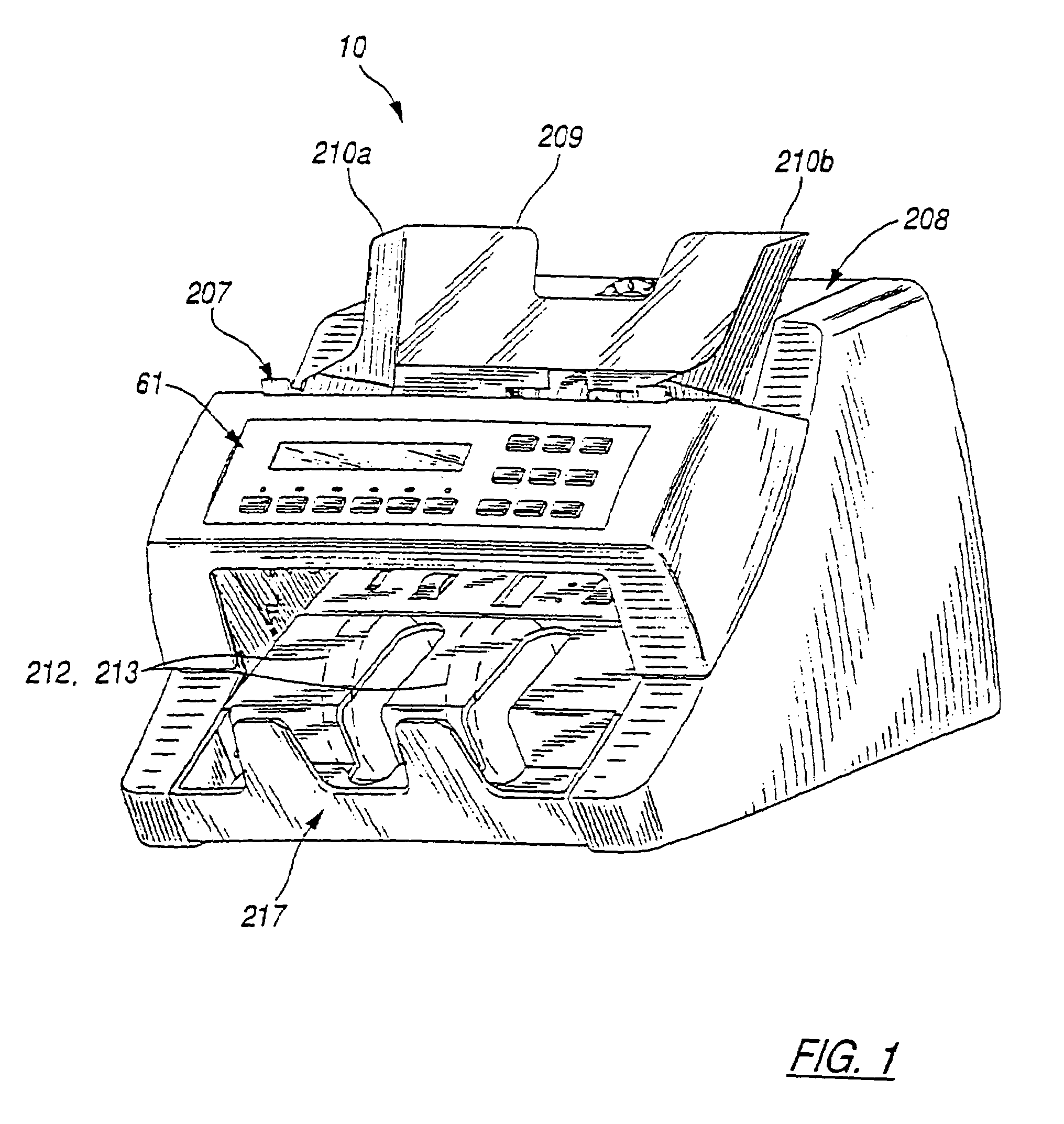

According to one embodiment of the present invention, a currency processing device for receiving and processing a stack of currency bills is disclosed. The currency processing device comprises an input receptacle for receiving a stack of bills to be processed, a plurality of output receptacles for receiving bills after the bills have been processed, a transport mechanism for transporting the bills from the input receptacle to the output receptacles, and a discriminating unit for examining the bills. The output receptacles are arranged such that a center of at least one output receptacle is laterally offset from a center of the input receptacle. The discriminating unit includes a detector positioned between the input receptacle and the output receptacles and is adapted to determine the denomination of bills.

Owner:CUMMINS-ALLISON CORP

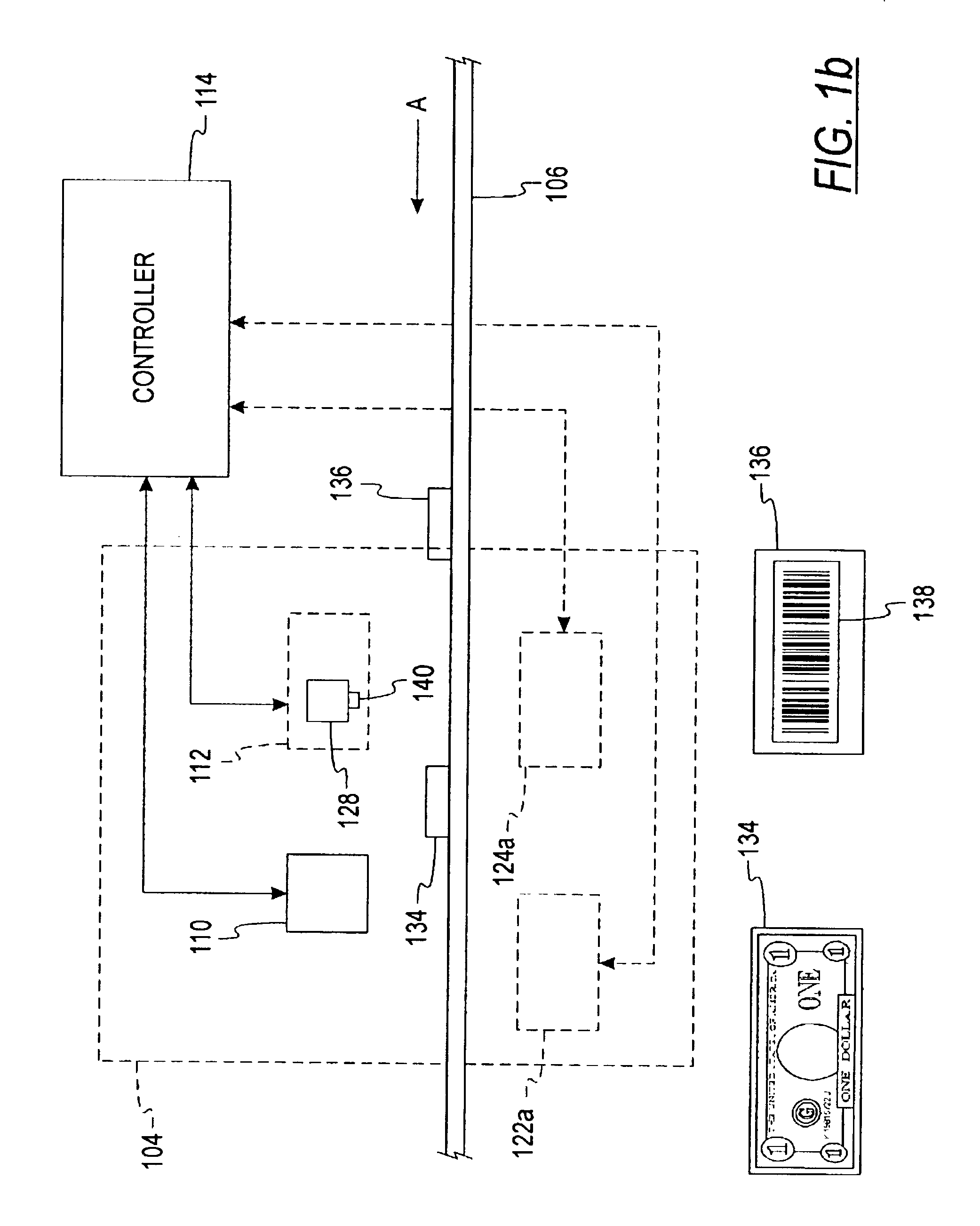

System and method for processing currency bills and documents bearing barcodes in a document processing device

A document processing device having an evaluation region disposed along a transport path between an input and output receptacle capable of processing both currency bills and barcoded media having at least two barcodes. One of the barcodes encodes a ticket number and another barcode encodes a payout amount associated with that ticket number. The evaluation region includes detectors for detecting predetermined characteristics of currency bills and a barcode reader for scanning the barcodes printed on the barcoded media. A controller coupled to the evaluation region controls the operation of the document processing device and receives input from and provides information to a user via a control unit In some embodiments, the document processing device may have any number of output receptacles, and the control unit allows the user to specify which output receptacle receives which type of document An optional coin sorter may be coupled to the document processing device to allow document and coin processing The document processing device may be coupled to a network to communicate information to devices linked to the network.

Owner:CUMMINS-ALLISON CORP

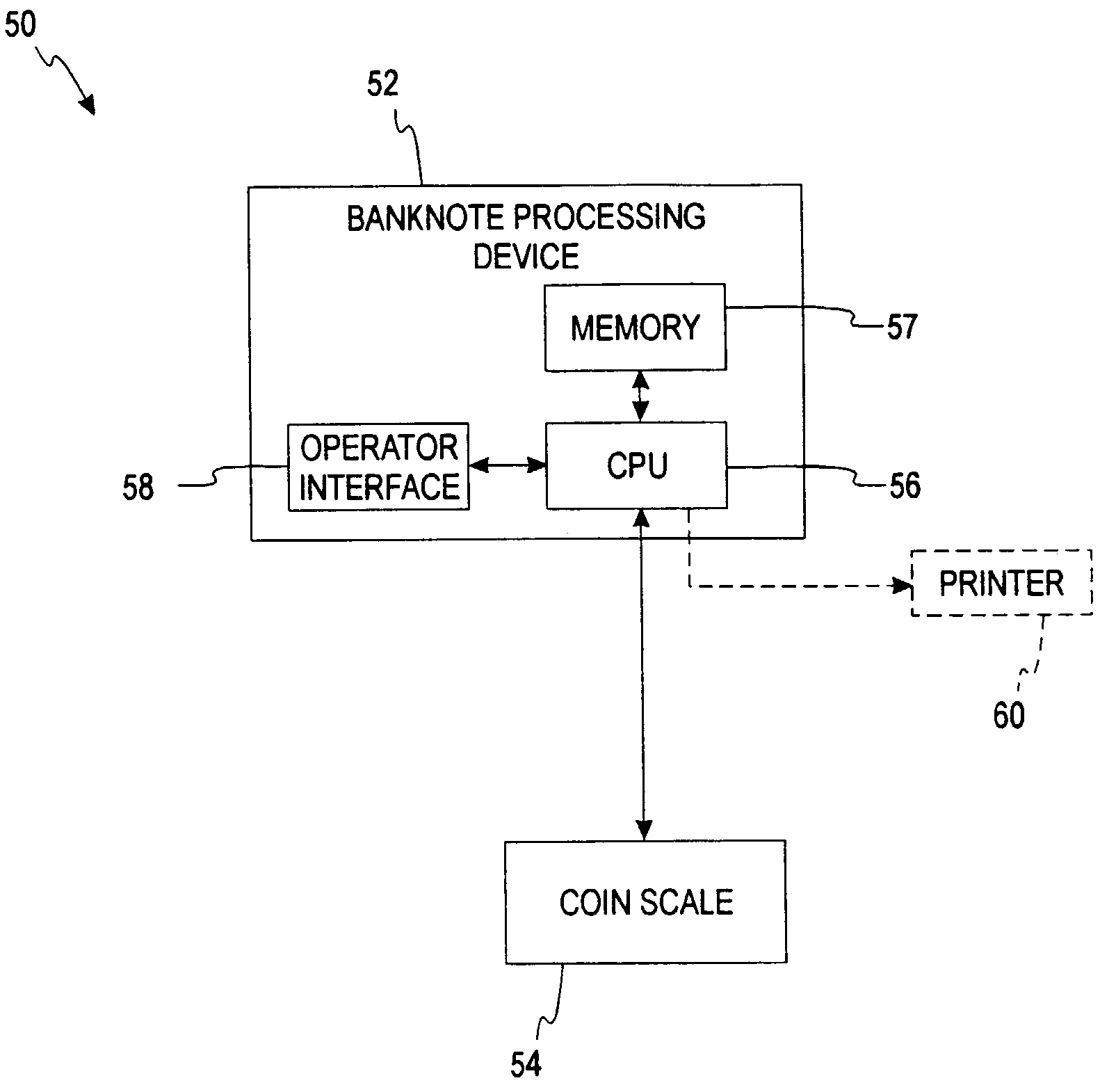

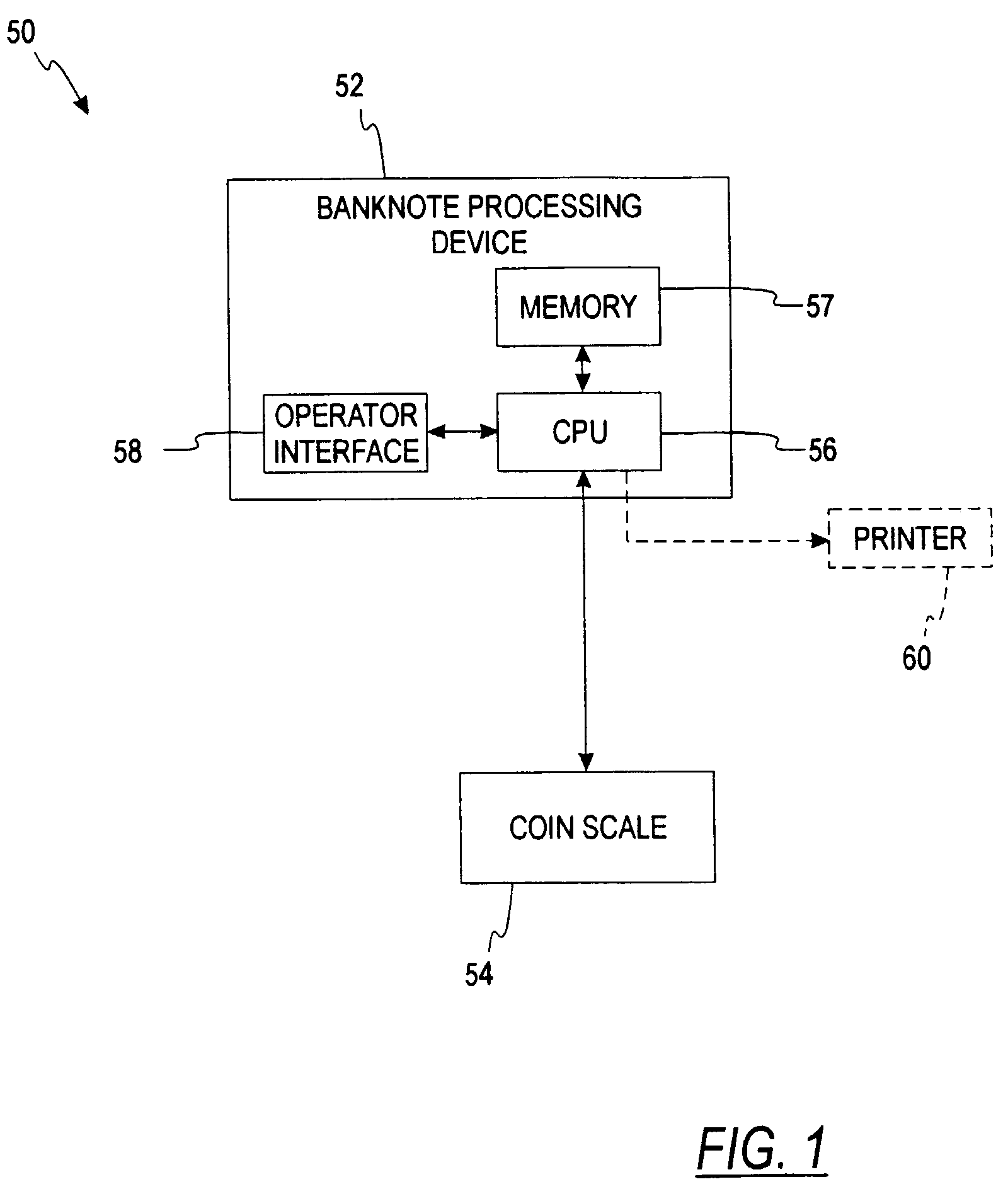

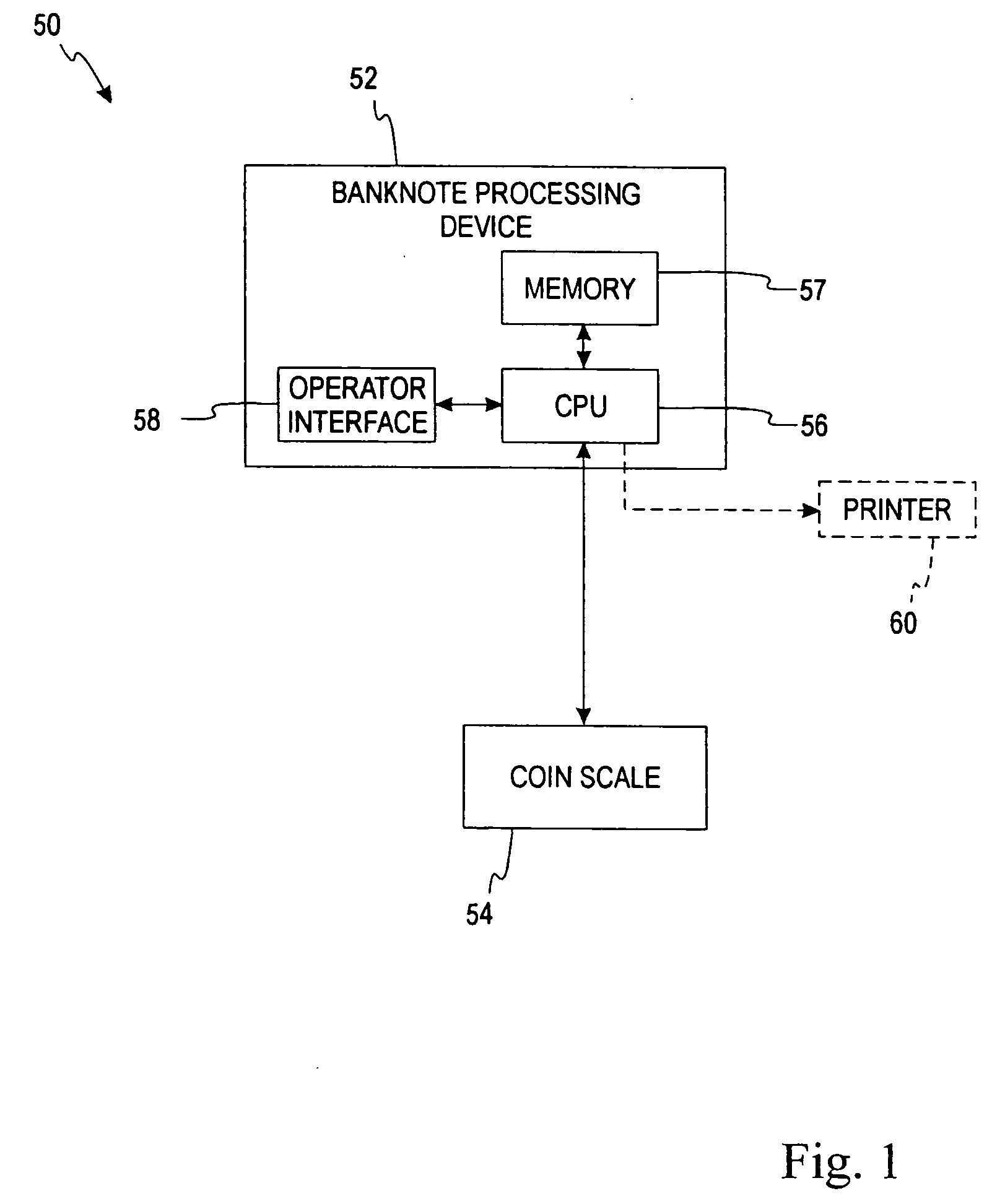

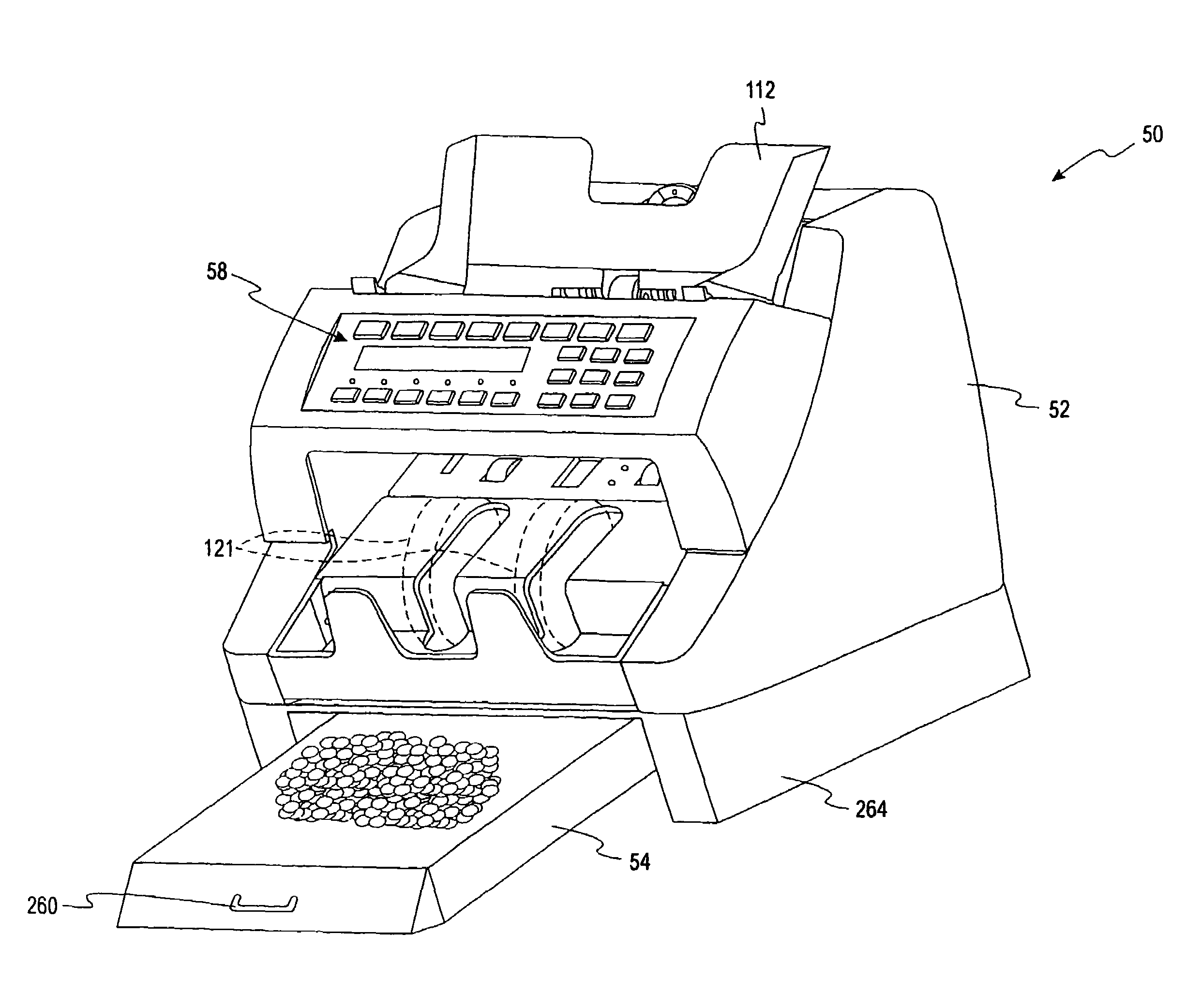

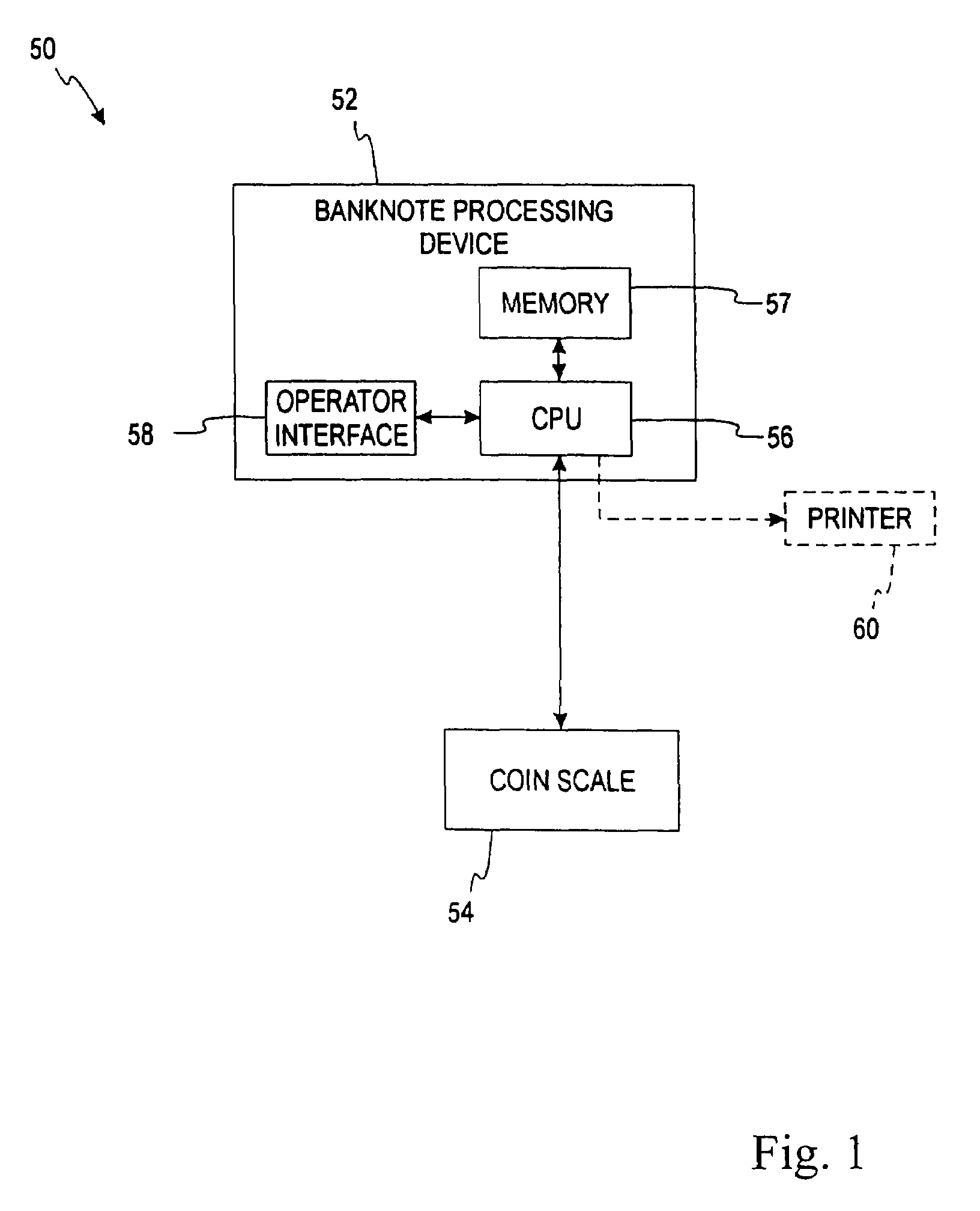

Currency bill and coin processing system

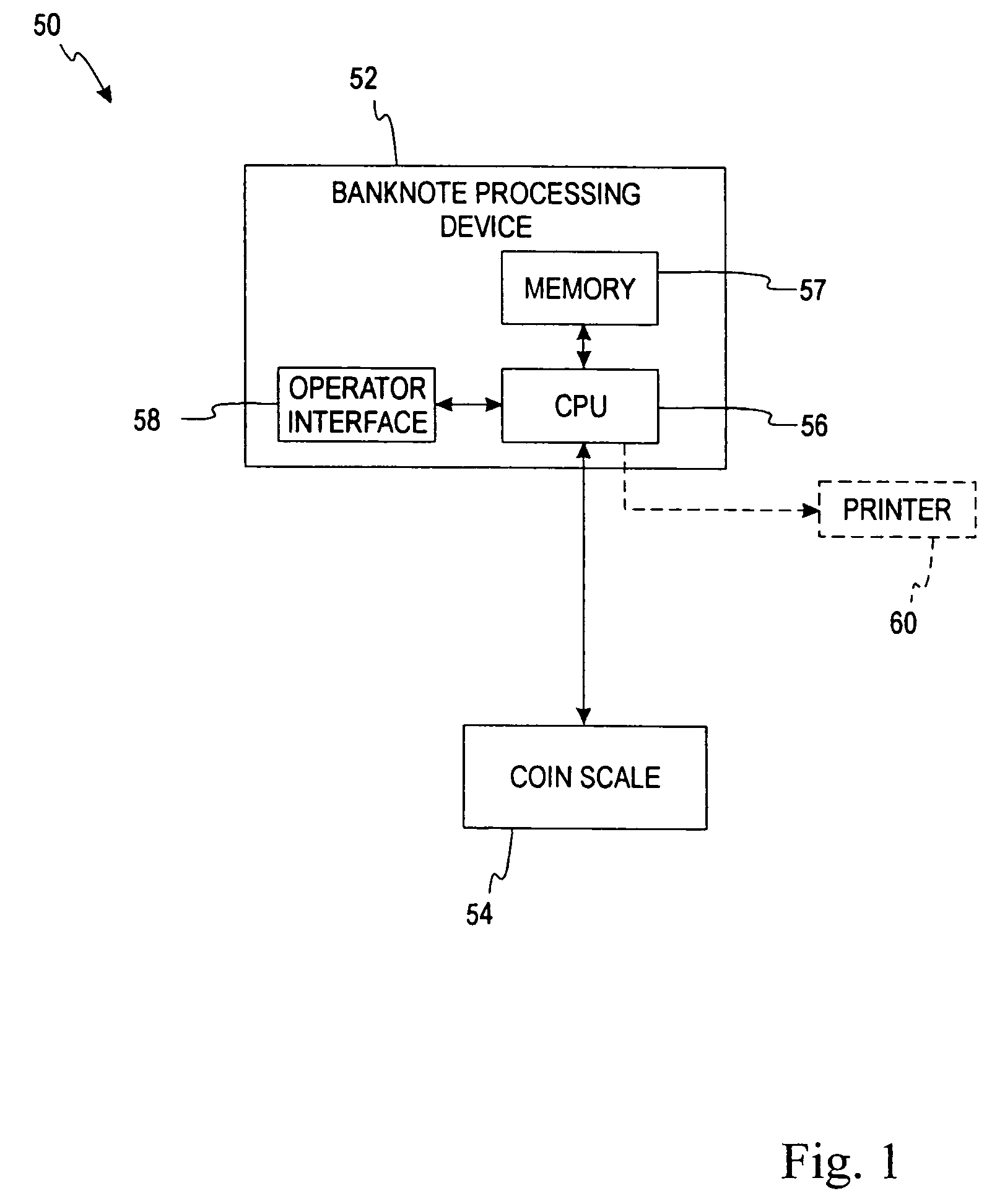

A compact system for processing currency bills and coins comprises a compact currency bill processing device, a coin scale, and a processor communicatively linked to the currency bill processing device and the coin scale. The compact currency bill processing device counts currency bills of a plurality of denominations. The compact currency bill processing includes an evaluation unit being that is adapted to determine the denomination of each of the currency bills. The coin scale is adapted to receive at least one group of coins of a single denomination and to determine a coin total for the at least one received group corresponding to the value of the coins in the received group. The processor is adapted to receive a currency bill total from the currency bill processing device and the coin total from the coin scale and to determine an aggregate total corresponding to the sum of the received currency bill total and the coin total.

Owner:CUMMINS-ALLISON CORP

Multiple pocket currency bill processing device and method

InactiveUS20050150738A1Paper-money testing devicesFunction indicatorsOperations researchData science

Owner:CUMMINS-ALLISON CORP

Currency processing and strapping systems and methods

A method and device for evaluating currency bills using a strapping unit that allows a currency evaluating device to automatically strap stacks of currency bills. Currency bills are placed in an input receptacle and an evaluating unit processes each currency bill one at a time. The currency bills are then transported to a plurality of output receptacles within a strapping unit. A stack moving mechanism transports a stack of currency bills, which contains a predetermined number of currency bills, from each of the plurality of output receptacles to the strapping unit or a strapping position. Each stack of currency bills is strapped using strapping material.

Owner:CUMMINS-ALLISON CORP

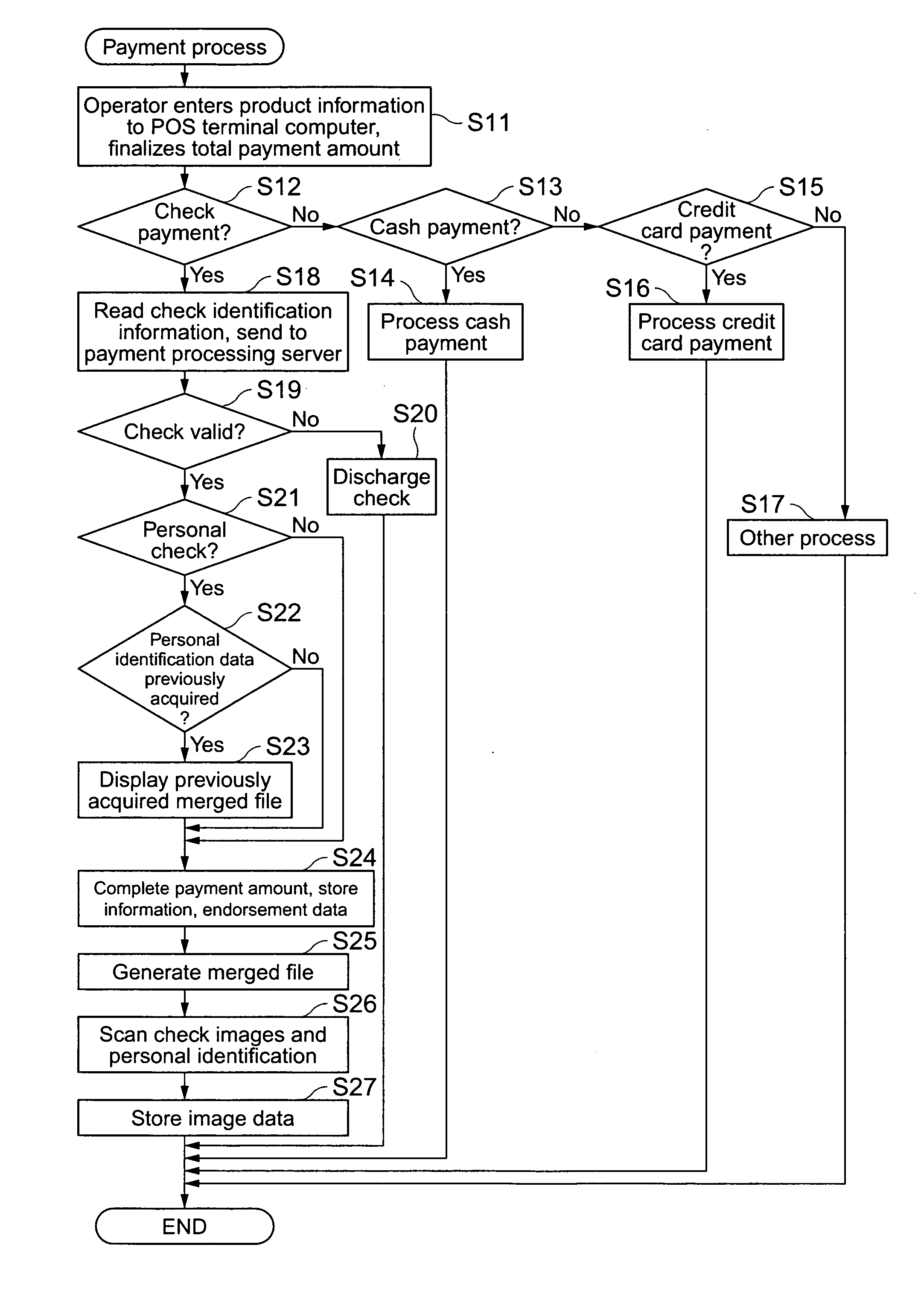

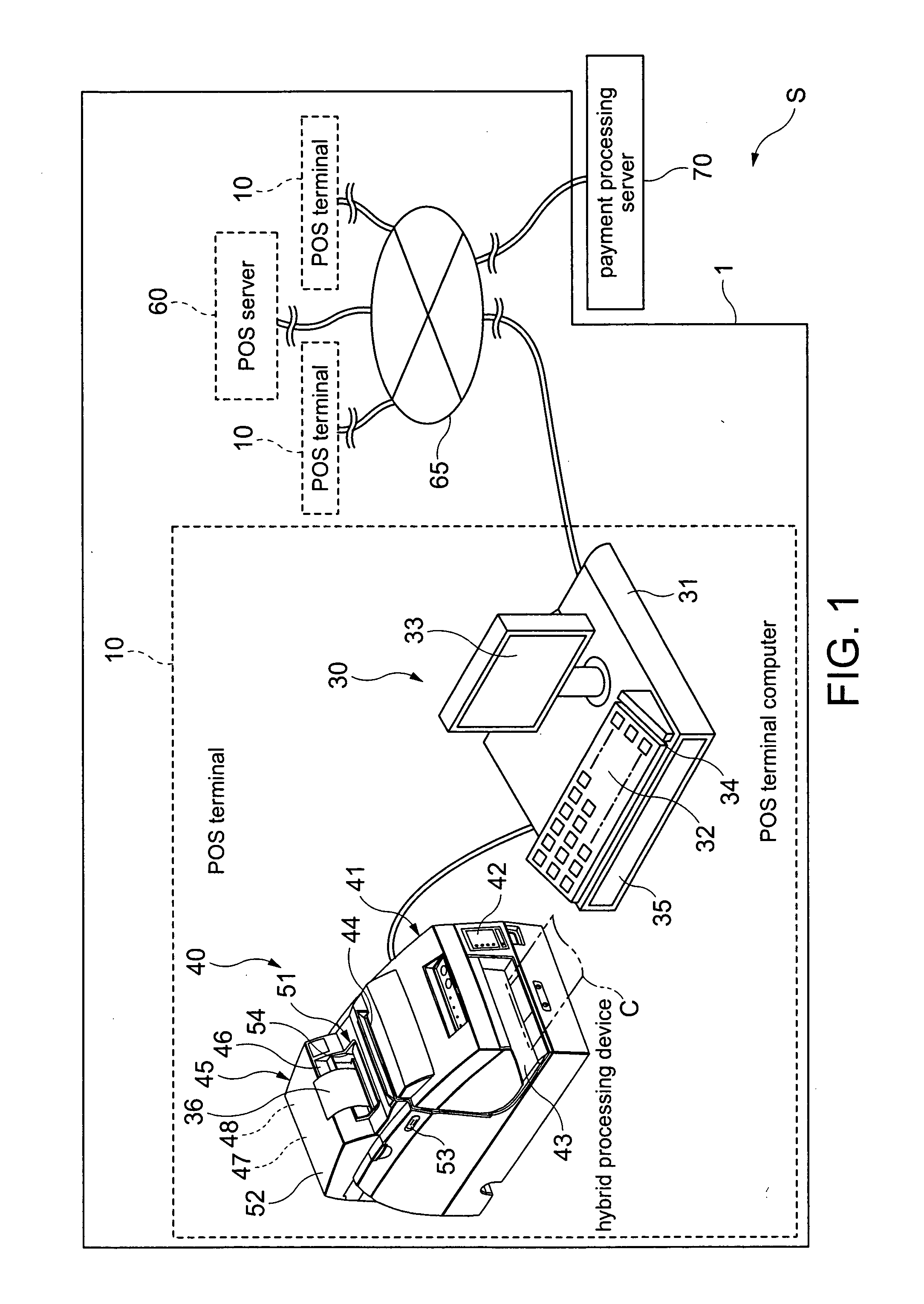

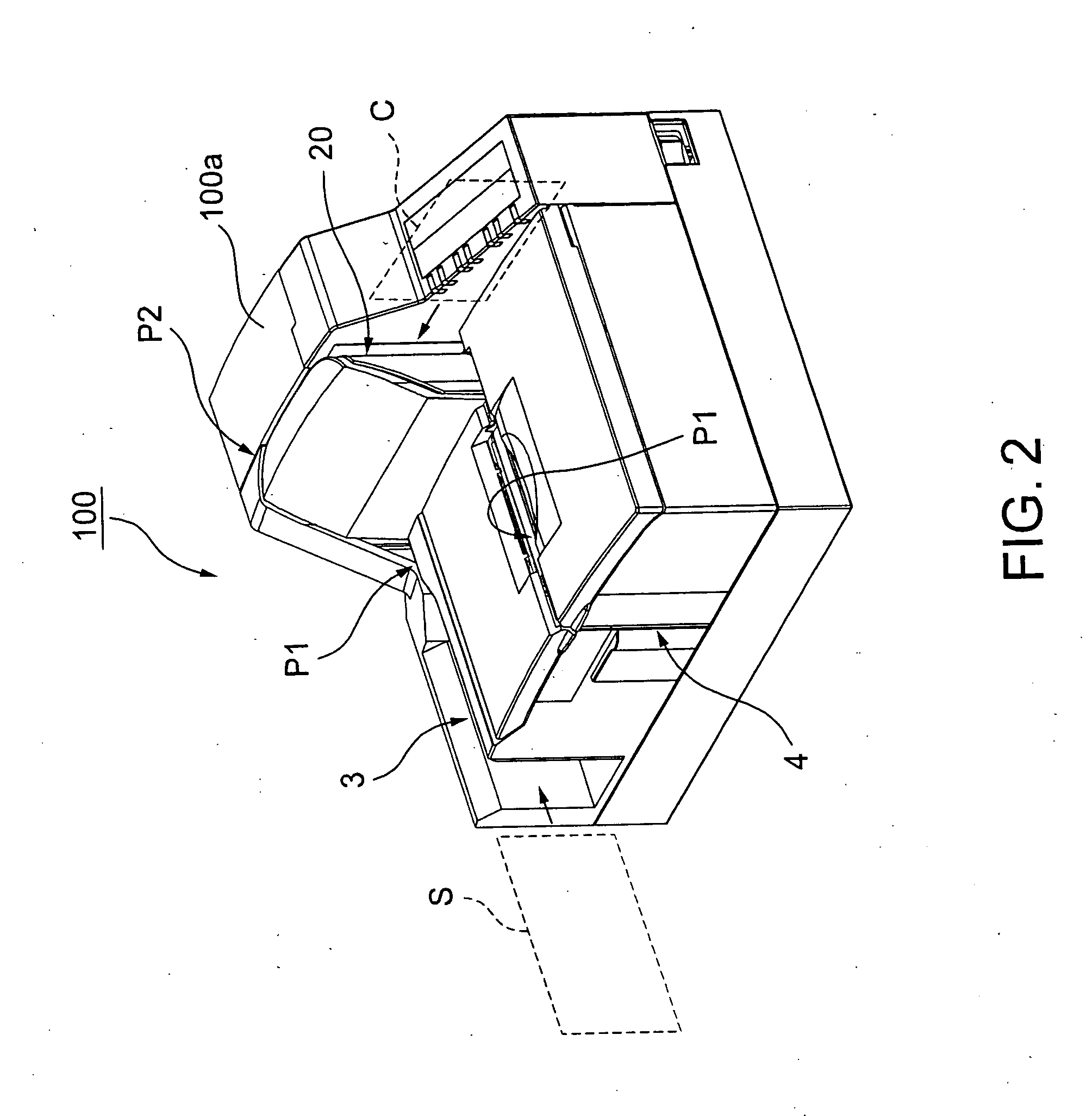

Check processing apparatus, program, electronic payment system, and check processing method

InactiveUS20050033695A1Prevent illicit check usageEffectively outputting identificationFinanceGeometric image transformationComputer hardwareDisplay device

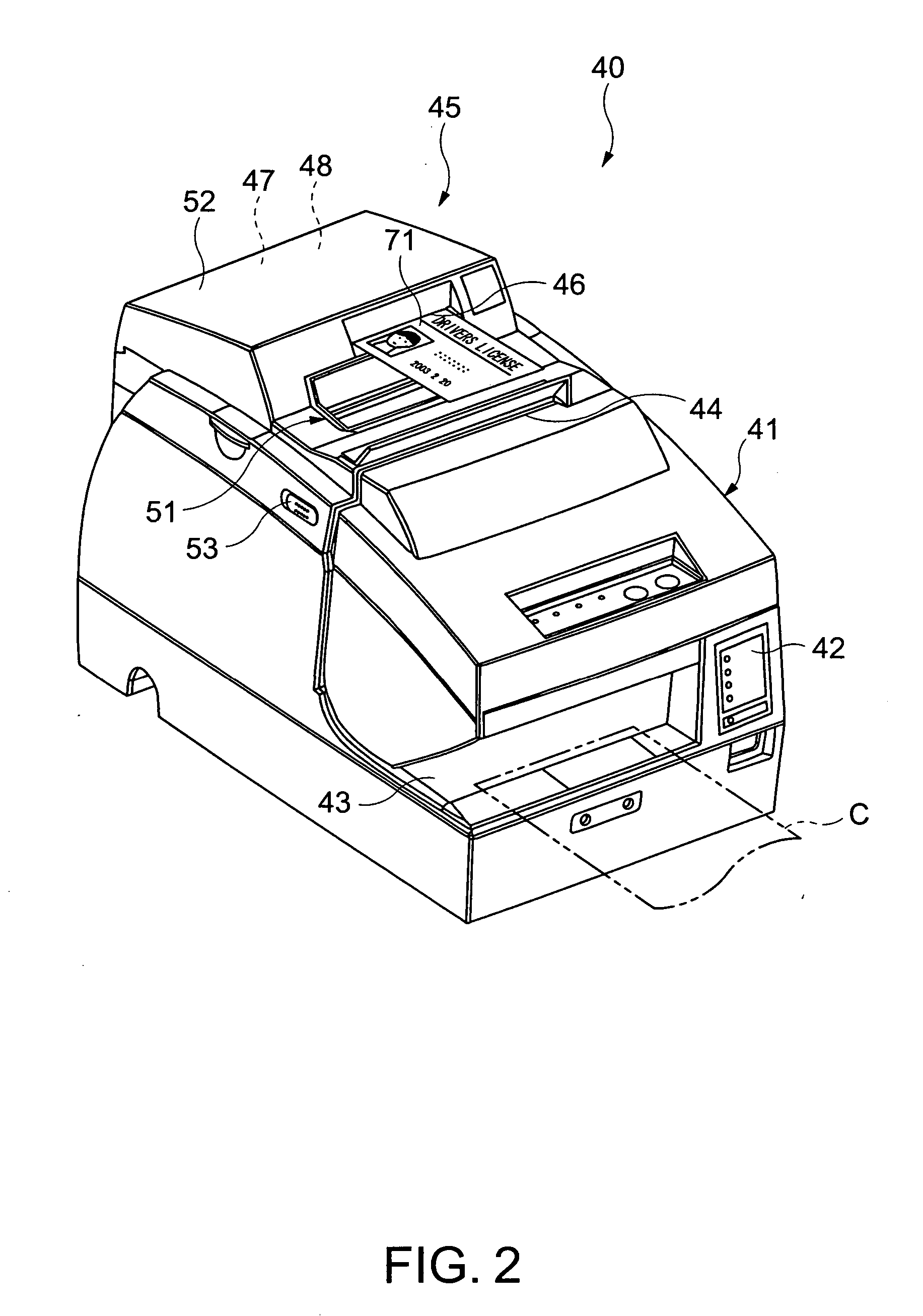

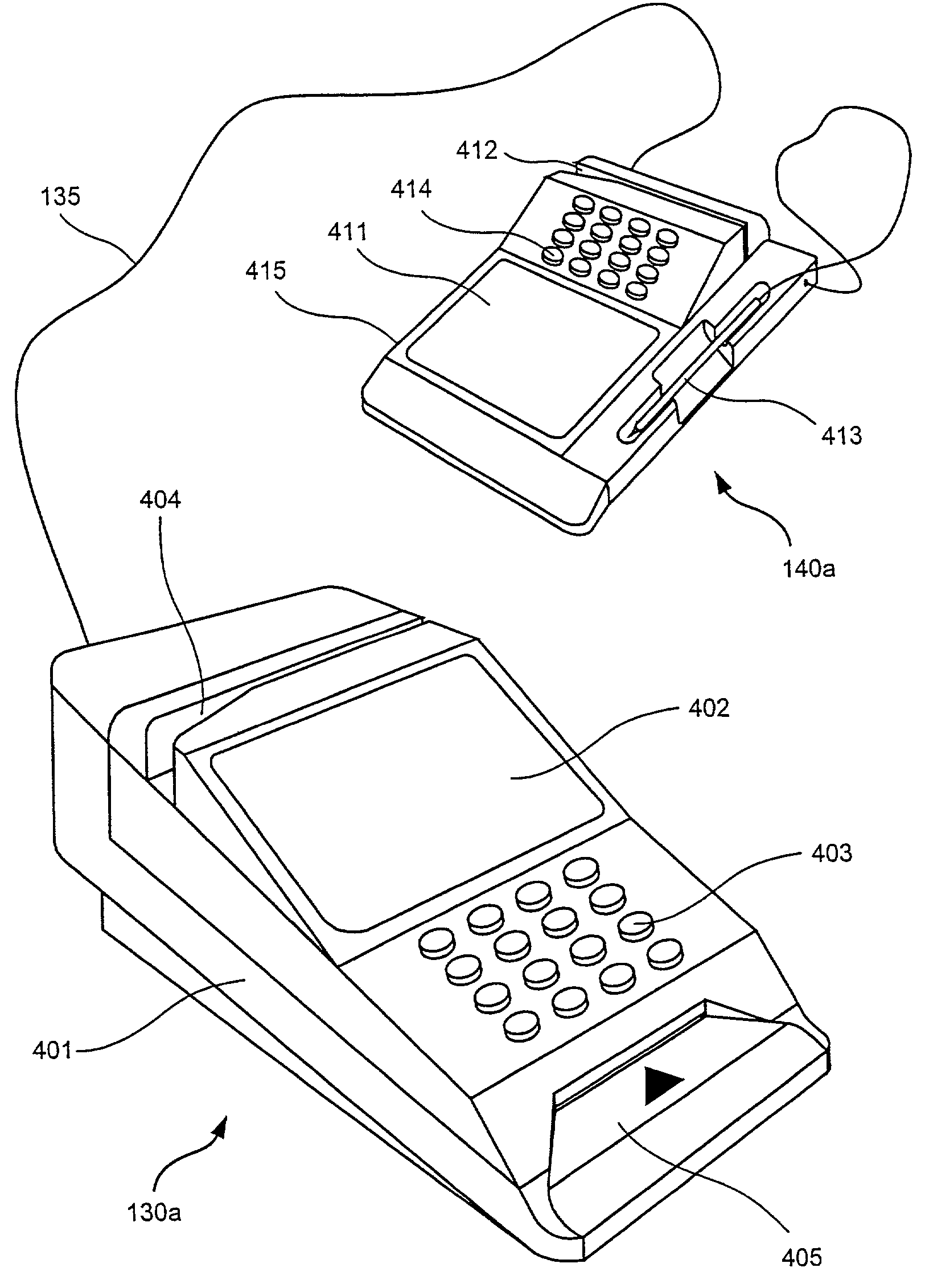

A check processing apparatus and method acquire and save data verifying the identity of a person using a check, and output this information in an effective manner to prevent improper use of the check. A check scanner 140 images all or part of the presented check C. A photo ID scanner 110 scans personal identification 71 presented as proof of identity by the person using the check, and a controller 160 converts the scanner output to generate personal identification image data. A merge file generating means 170 merges the image data from the check scanner with the personal identification image data to produce a merged file. The merged file is stored in merged file storage means 180 and output to a display 33.

Owner:SEIKO EPSON CORP

Currency processing device, method and system

InactiveUS20050183928A1Rapid assessmentClose proximityPaper-money testing devicesOverturning articlesEngineeringComputer science

According to one embodiment of the present invention, a currency processing device for receiving and processing a stack of currency bills is described. The currency processing device comprises an input receptacle for receiving a stack of bills to be processed, a plurality of output receptacles for receiving bills after the bills have been processed, a transport mechanism for transporting the bills from the input receptacle to the output receptacles, and a discriminating unit for examining the bills. The output receptacles are arranged such that a center of at least one output receptacle is laterally offset from a center of the input receptacle. The discriminating unit includes a detector positioned between the input receptacle and the output receptacles and is adapted to determine the denomination of bills.

Owner:CUMMINS-ALLISON CORP

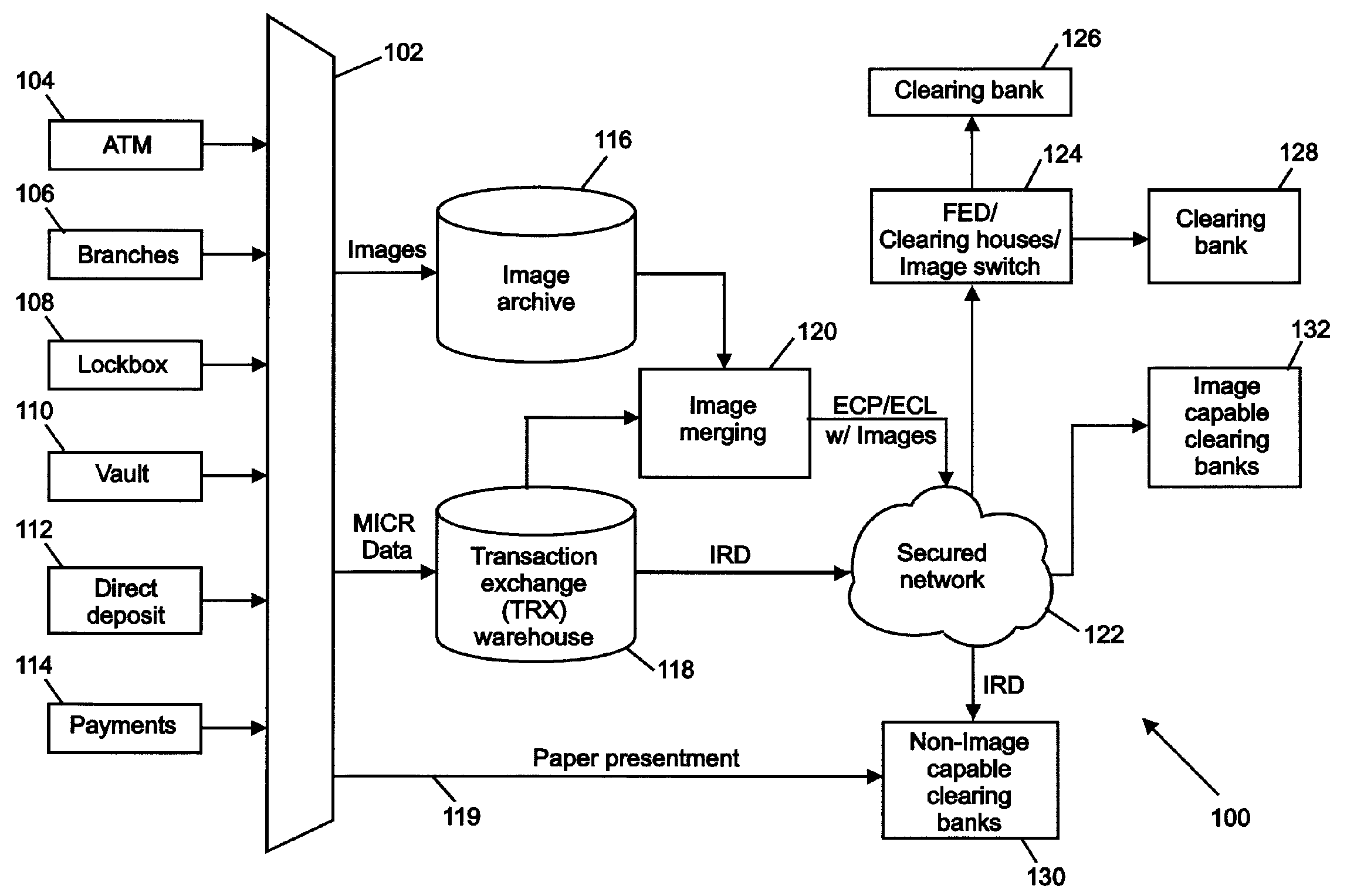

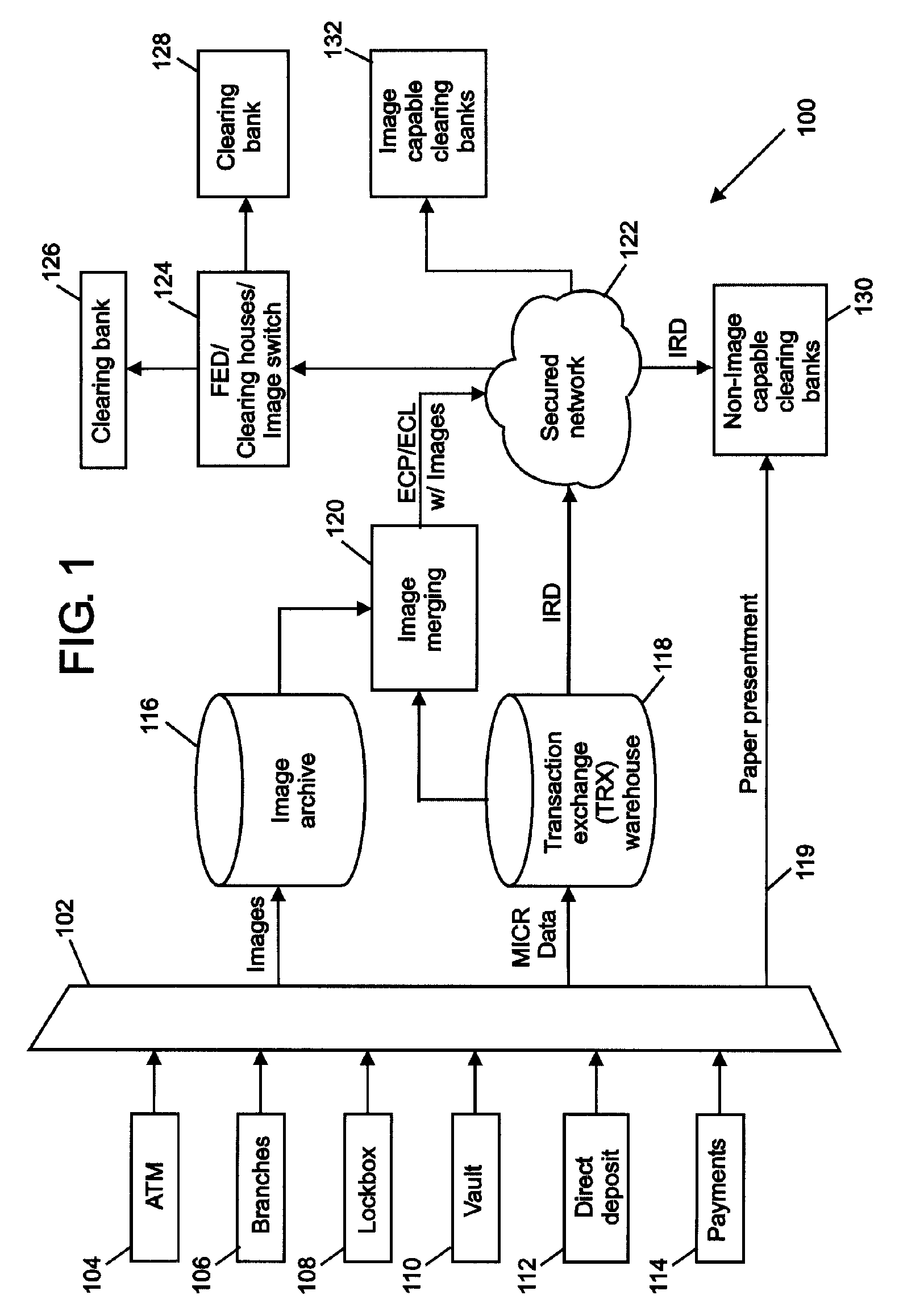

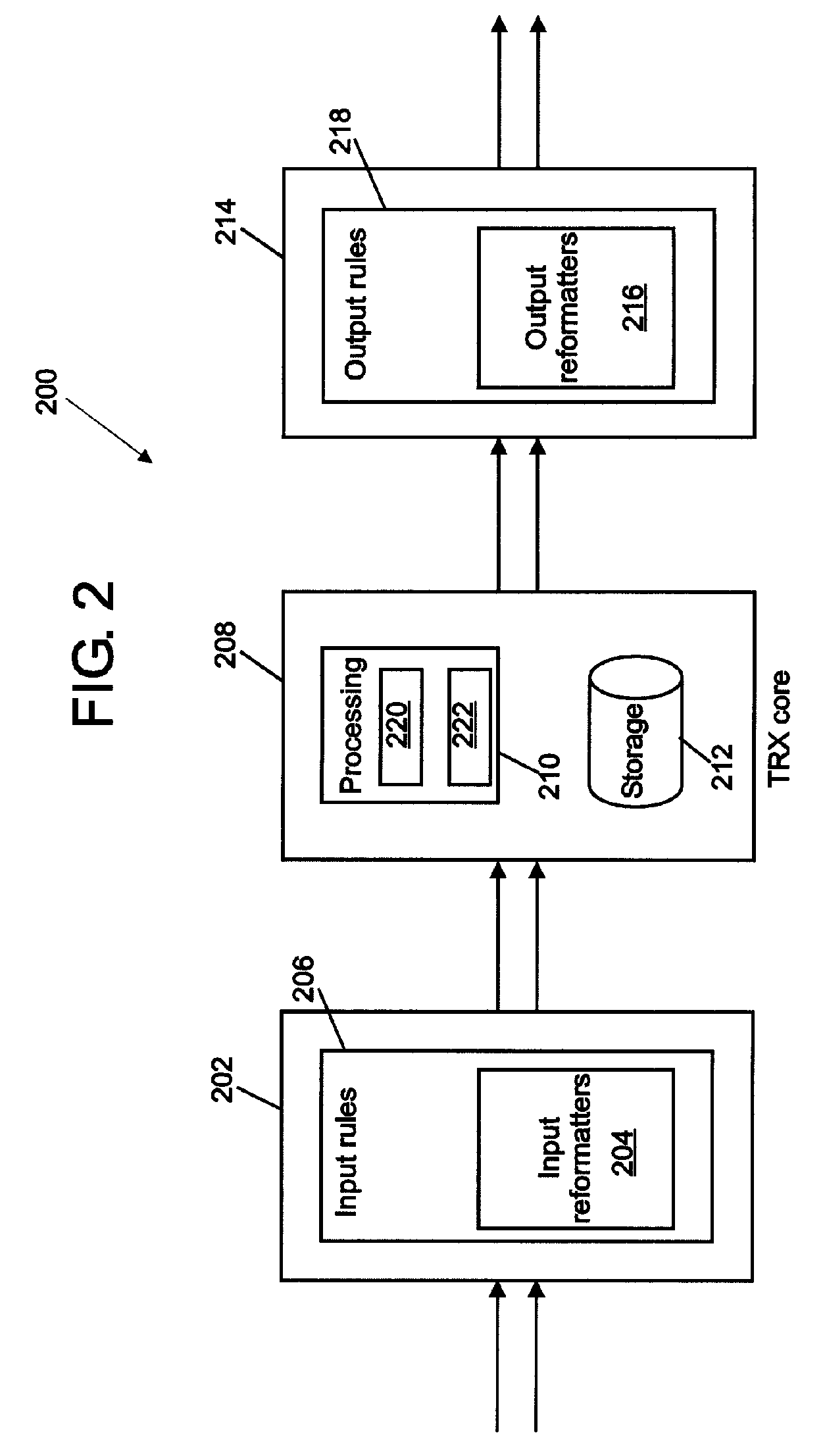

Method and system for consolidating cash letters

ActiveUS20060118613A1Easy to trackEasy to reportComplete banking machinesFinanceData warehouseDistribution control

Method and system for consolidating cash letters. Embodiments of the invention provide methods and systems for consolidating cash letter data from a plurality of capture devices and sources. In example embodiments, data from multiple sites and sources can be assembled into a single, endpoint file for a specific clearing institution. The reformatting and distributing of this data can be accomplished using endpoint specific rules and specifications. In some embodiments, a transaction exchange (TRX) stores cash letter data according to a file key and applies the endpoint specific distribution controls to the data to create the specific endpoint files. The transaction exchange can take the form of a data warehouse with processing and storage capabilities necessary to sweep the appropriate cash letter data into an endpoint file as needed. An image archive can be provided to enable appending images to endpoint files.

Owner:BANK OF AMERICA CORP

Currency bill and coin processing system

Owner:CUMMINS-ALLISON CORP

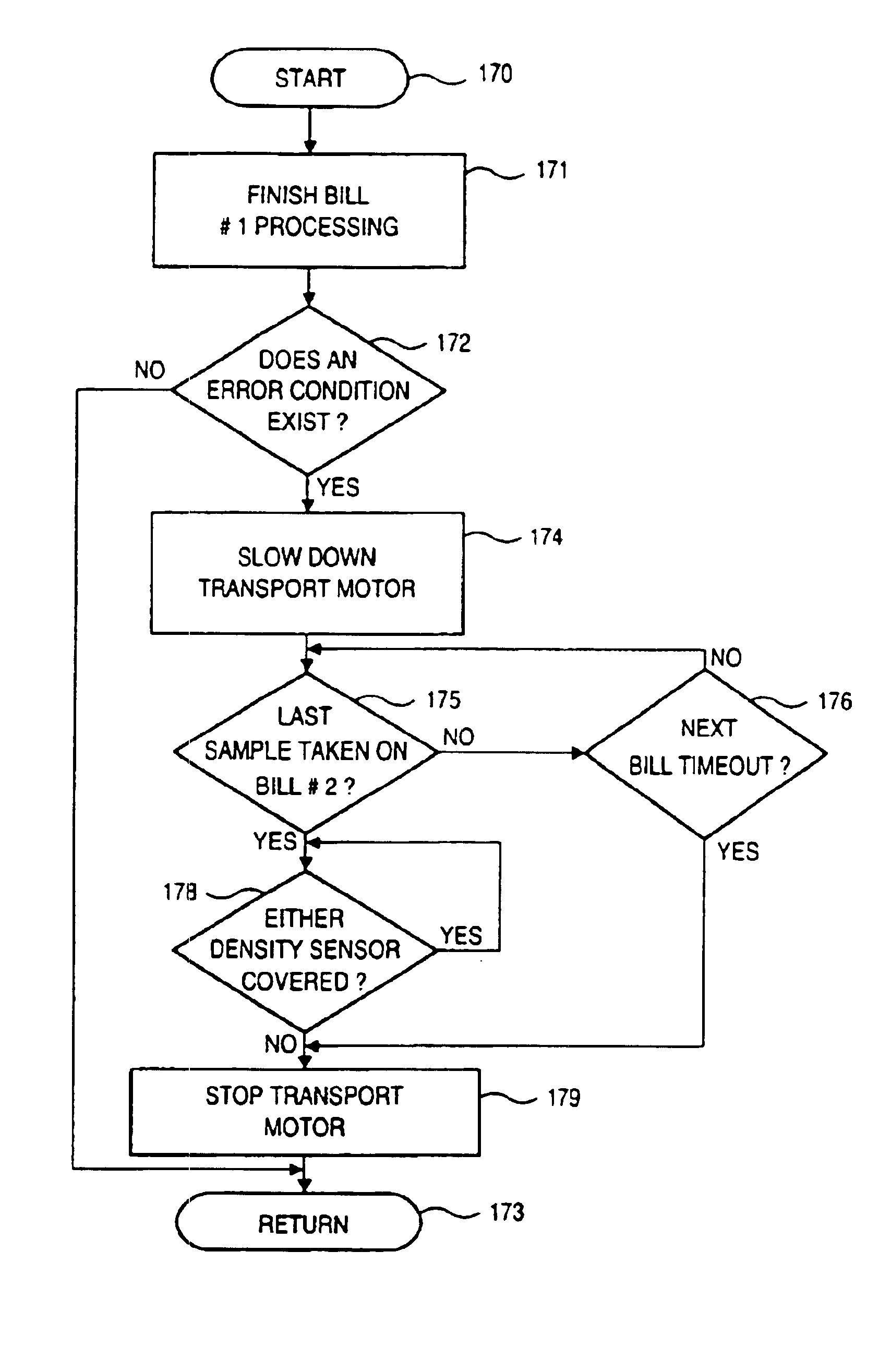

Currency handling system having multiple output receptacles

InactiveUS6994200B2Paper-money testing devicesRegistering/indicating working of machinesEngineeringHandling system

A method and apparatus for handling bill jams within a currency processing device is provided. The device includes a transport mechanism adapted to transport bills along a transport path, one at a time, from the input receptacle past an evaluation unit into a plurality of output receptacles. At least one of the output receptacles includes a holding area and a storage area. A plurality of bill passage sensors are sequentially disposed along the transport path that are adapted to detect the passage of a bill as each bill is transported past each sensor. An encoder is adapted to produce an encoder count for each incremental movement of the transport mechanism. A controller counts the total number of bills transported into each of the holding areas and the total number of bills moved from a holding area to a corresponding storage area after a predetermined number of bills have been transported into the holding area. The controller tracks the movement of each of the bills along the transport path into each of the holding areas with the plurality of bill passage sensors. The presence of a bill jam is detected when a bill is not transported past one of the plurality of bill passage sensors within a requisite number of encoder counts. The operation of the transport mechanism is suspended upon detection of a bill jam. The bills from each of the holding areas are moved to the corresponding storage areas upon suspension of the operation of the transport mechanism. Remaining bills are then flushed from the transport path after moving the bills from each of the holding areas to the corresponding storage areas upon suspension of the operation of the transport mechanism.

Owner:CUMMINS-ALLISON CORP

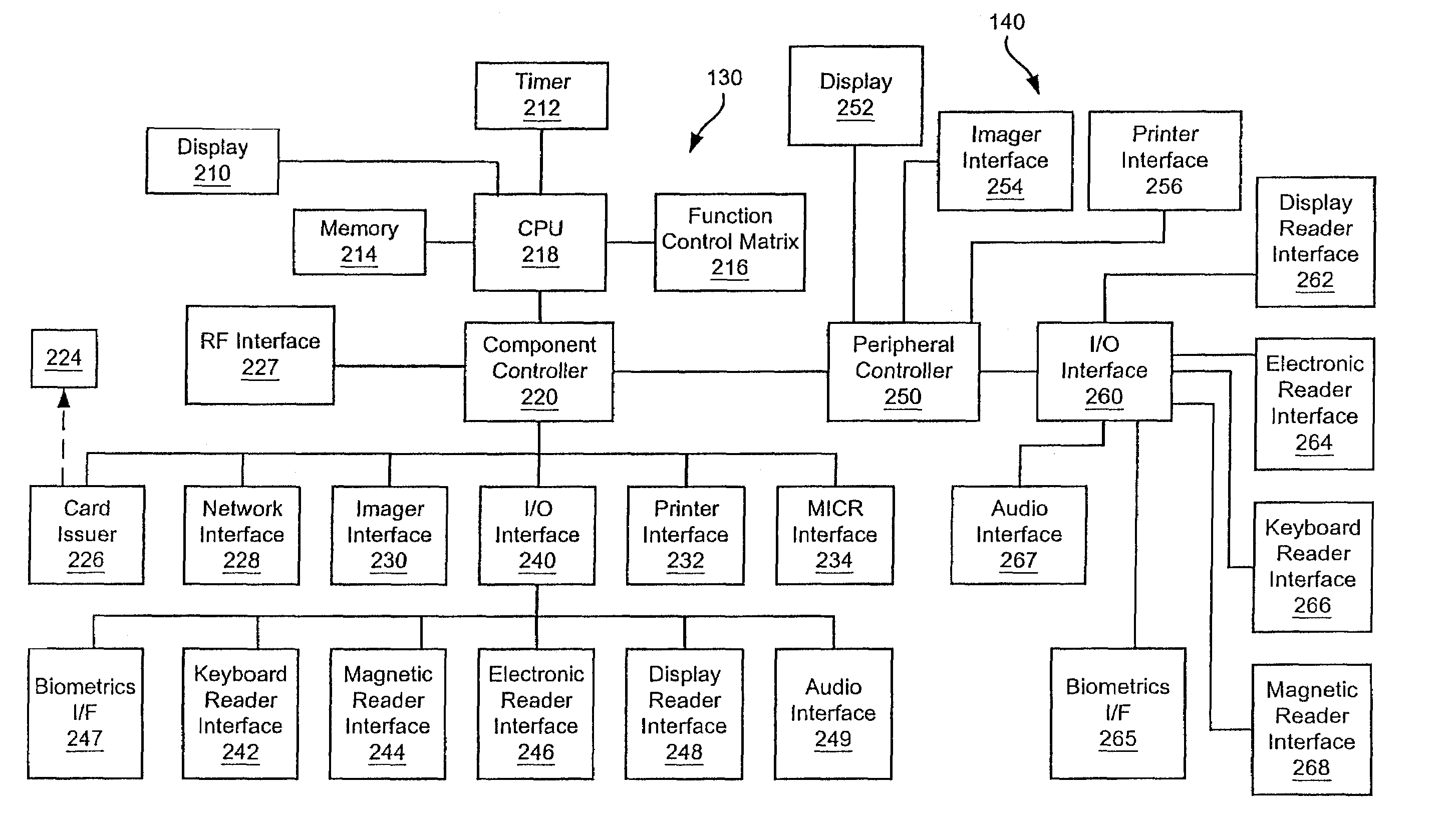

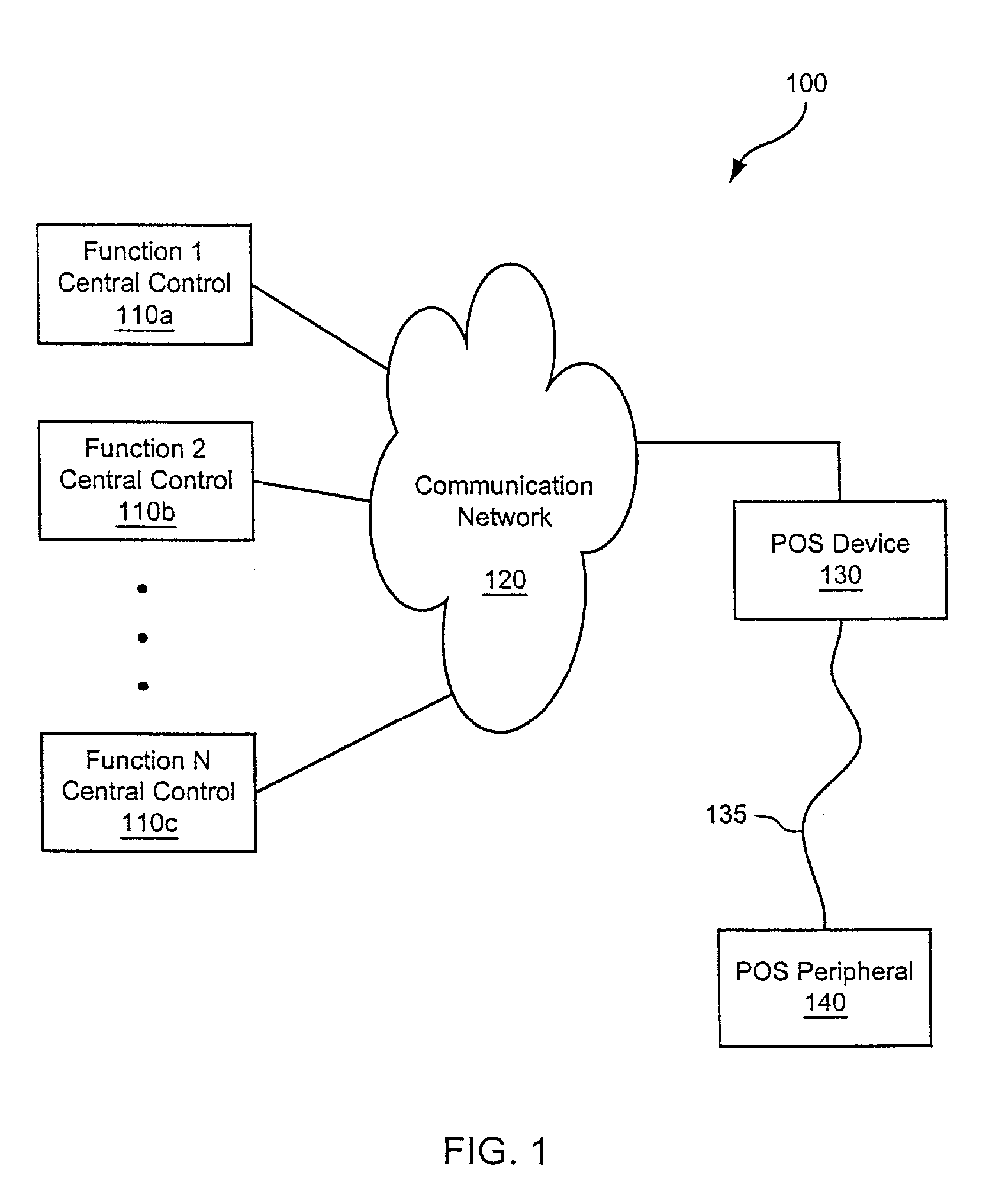

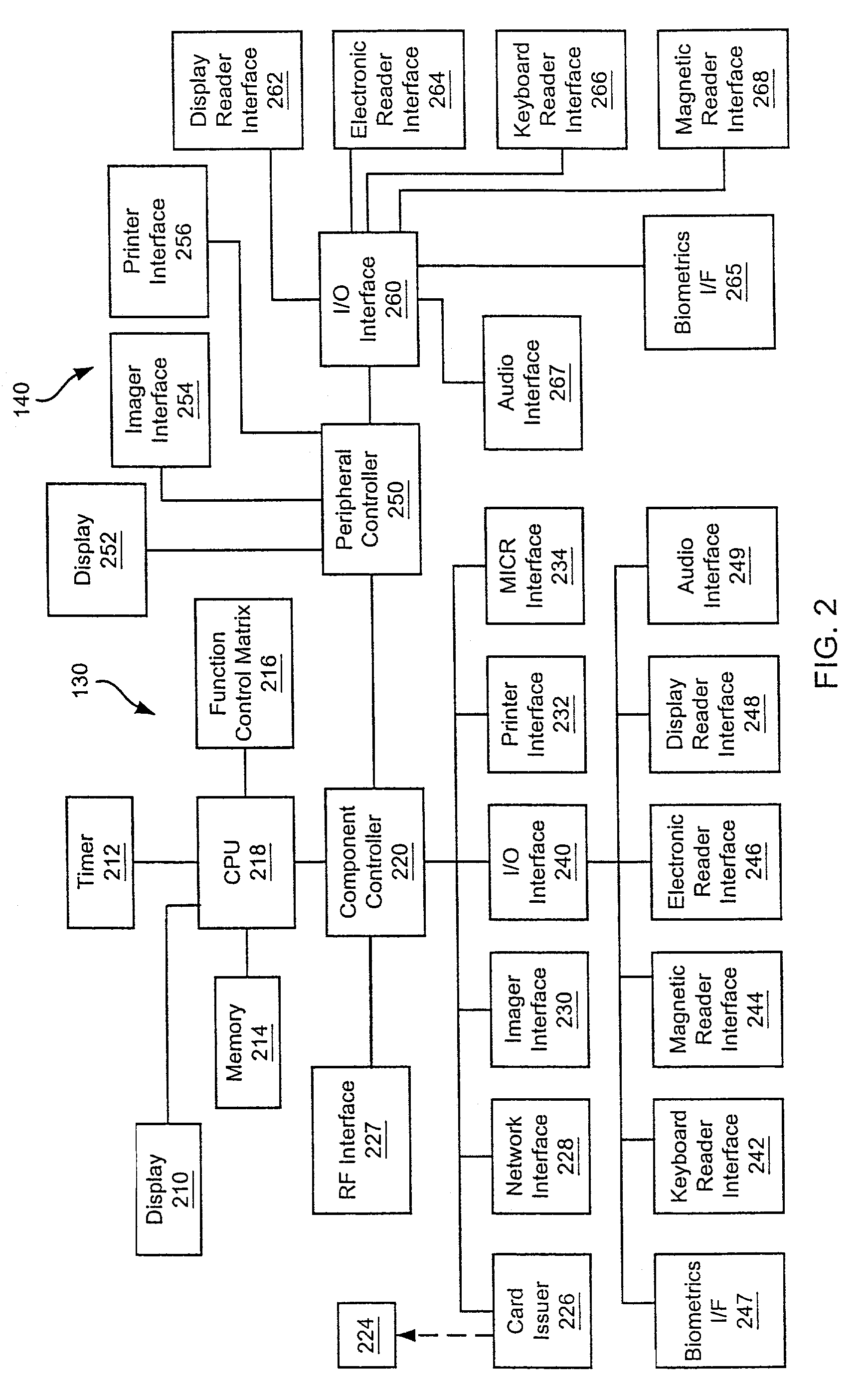

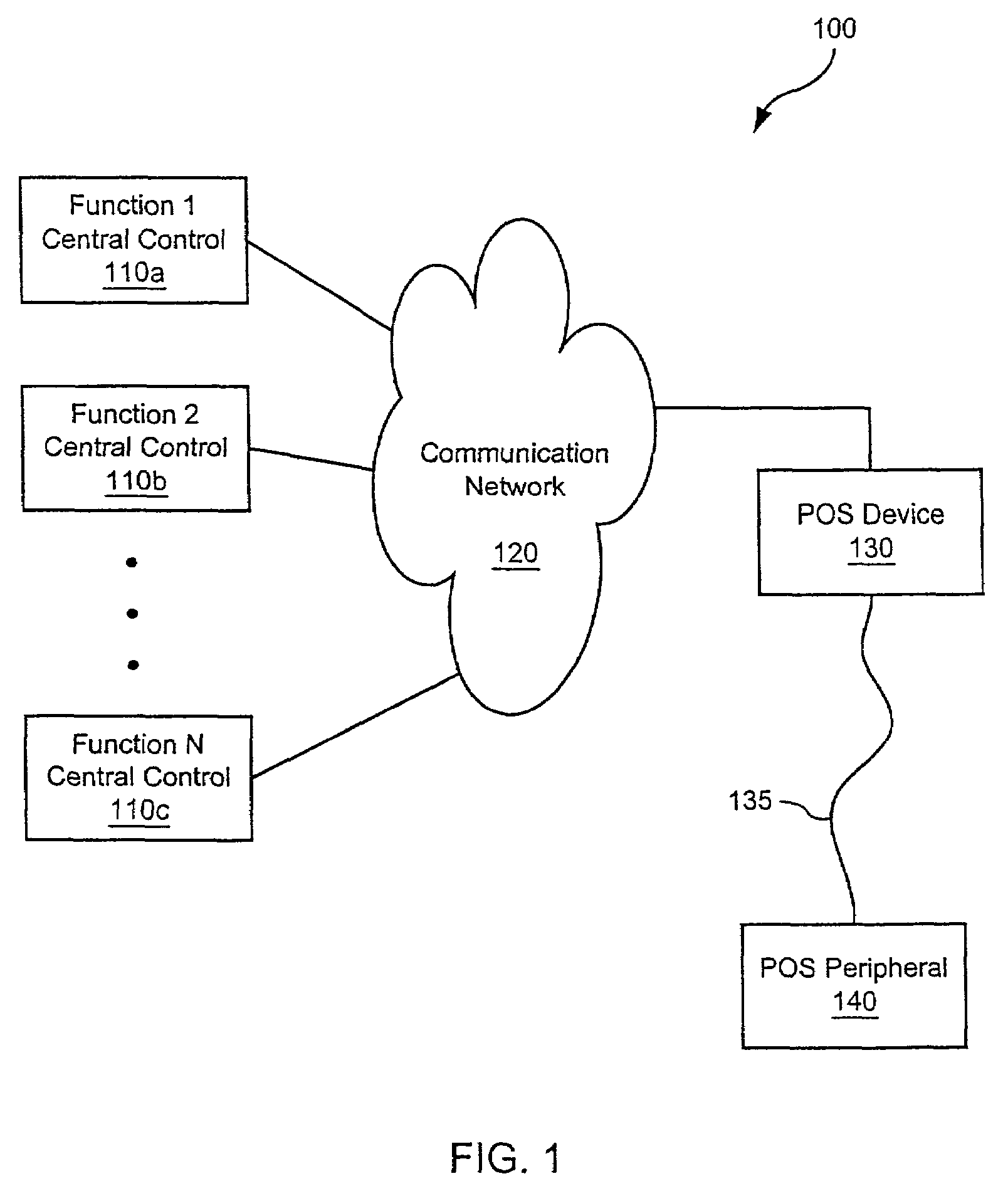

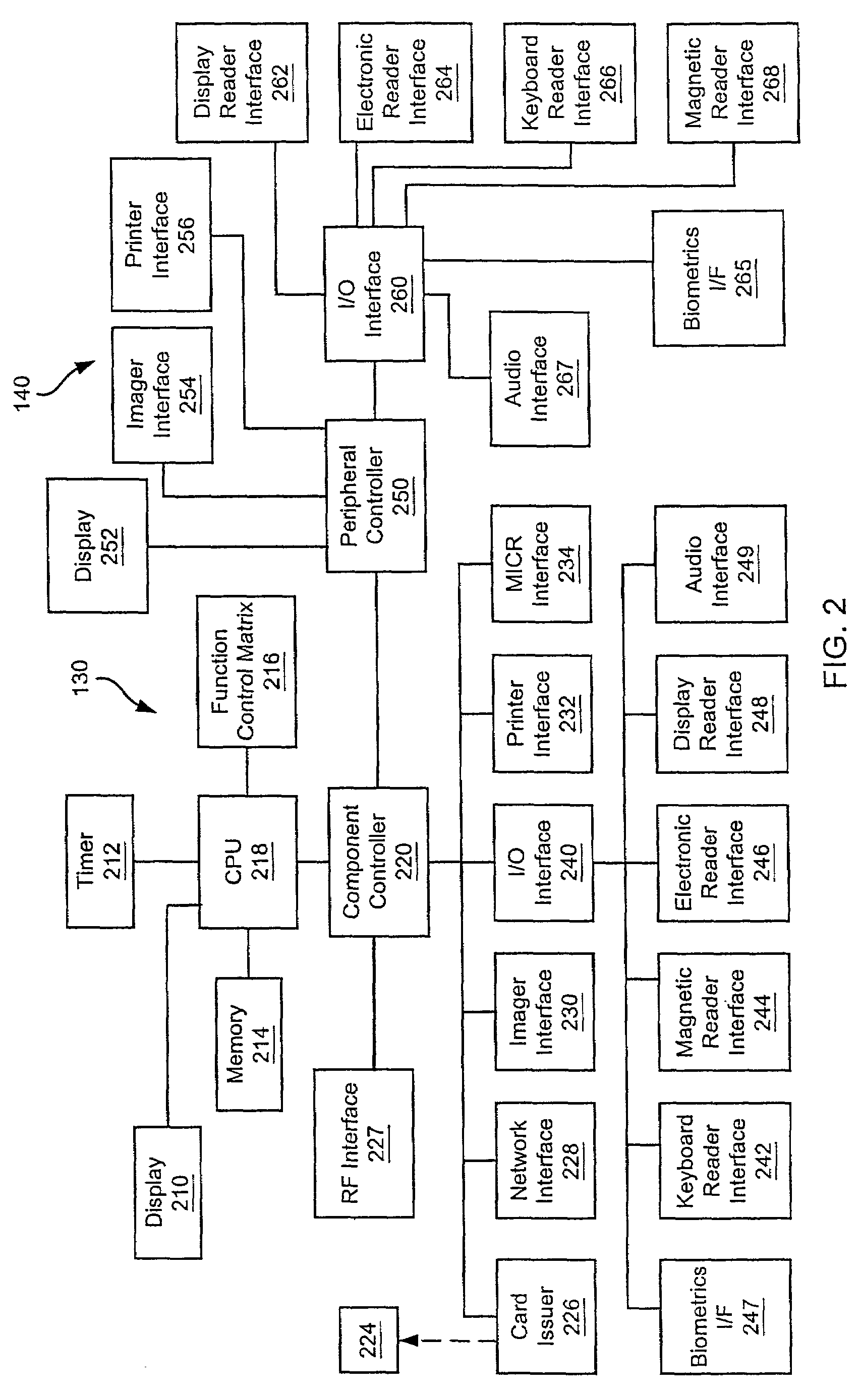

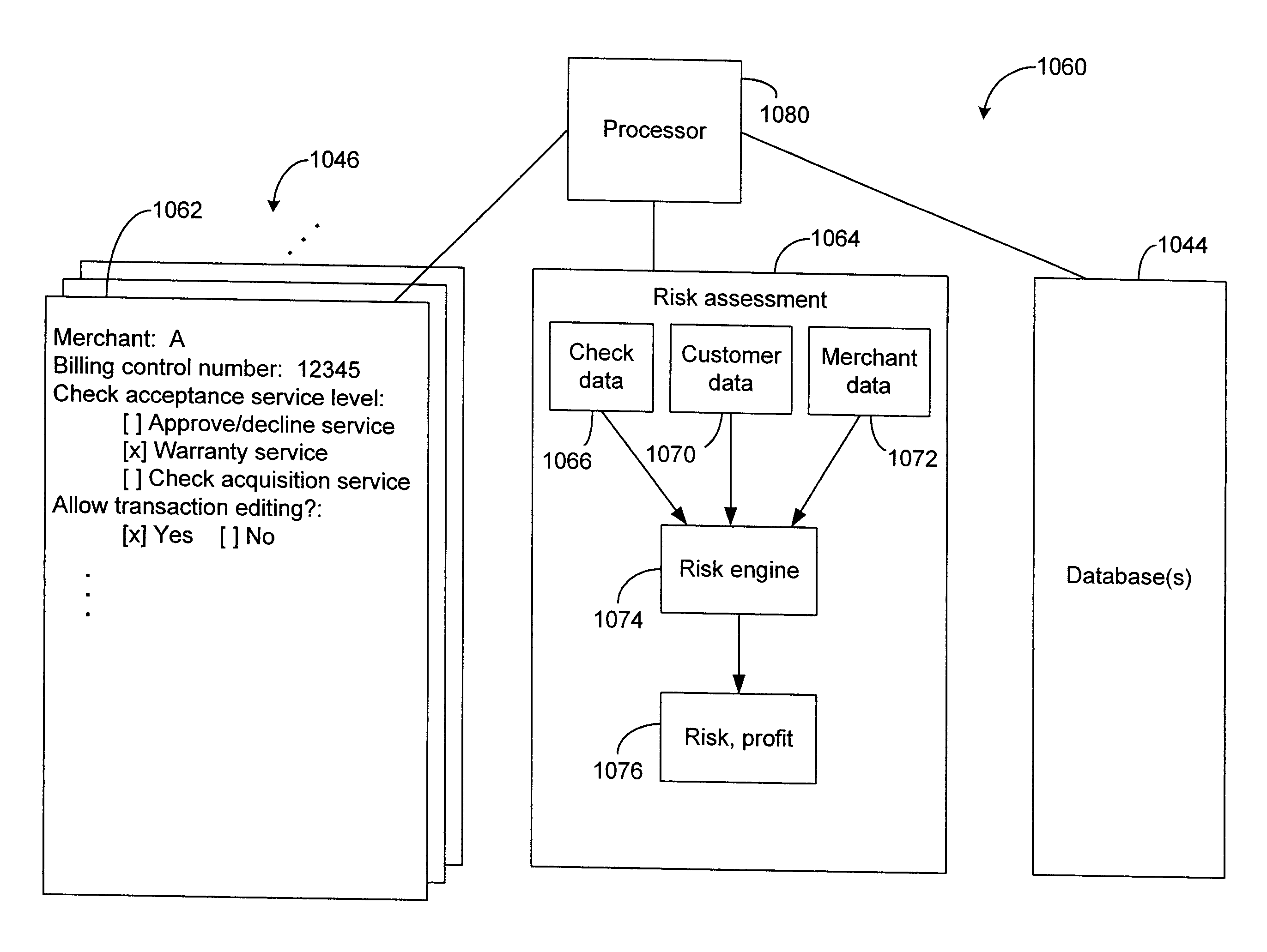

Systems and methods for configuring a point-of-sale system

Among other things, the present invention provides a variety of systems and methods for configuring and / or providing a configurable point-of-sale system. Various methods of the present invention include providing a point-of-sale device and coupling it to a communication network. One or more transaction systems are accessible to the point-of-sale device via the transaction network, instructions are loaded to the memory of the point-of-sale device allowing it to access the transaction system. Various systems include a plurality of point-of-sale devices communicably coupled to various transaction systems via a communication network. The point-of-sale devices can be configurable to access one or more of the various transaction systems.

Owner:THE WESTERN UNION CO +1

System and method for processing currency bills and documents bearing barcodes in a document processing device

A document processing device having an evaluation region disposed along a transport path between an input and output receptacle capable of processing both currency bills and substitute currency media having at least one indicia. The evaluation region includes at least one of a currency detector, a media detector, and an imager for detecting predetermined characteristics of currency bills and substitute currency media. A controller coupled to the evaluation region controls the operation of the document processing device and receives input from and provides information to a user via a control unit. In some embodiments, the document processing device may have any number of output receptacles, and the control unit allows the user to specify which output receptacle receives which type of document. An optional coin sorter may be coupled to the document processing device to allow document and coin processing. The document processing device may be coupled to a network to communicate information to devices linked to the network.

Owner:CUMMINS-ALLISON CORP

Currency bill and coin processing system

An integrated system for processing currency bills, coins, and other media includes a compact currency bill processing device, a coin scale, a keyboard, and a processor integrated into a housing as a single unit. The bill processing device is used for counting currency bills of a plurality of denominations and includes an input receptacle and a transport mechanism. The coin scale is adapted to determine a coin total for at least one group of coins. The keyboard is adapted to manually receive from an operator information related to at least one of the currency bills and the coins. The processor is communicatively linked to the currency bill processing device, the coin scale, and the keyboard and is adapted to determine an aggregate total corresponding to the sum of a received currency bill total, the coin total, and an other-media total.

Owner:CUMMINS-ALLISON CORP

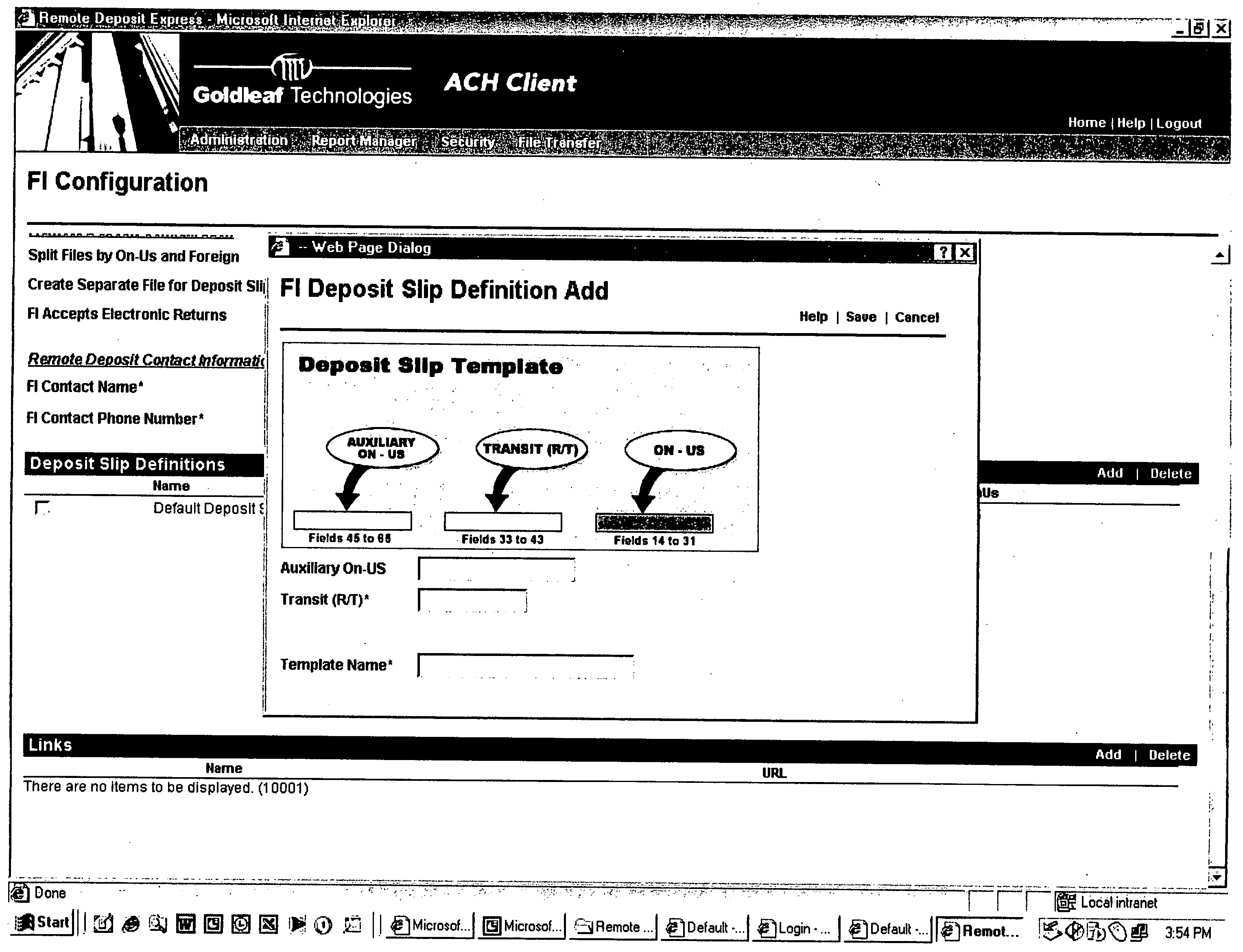

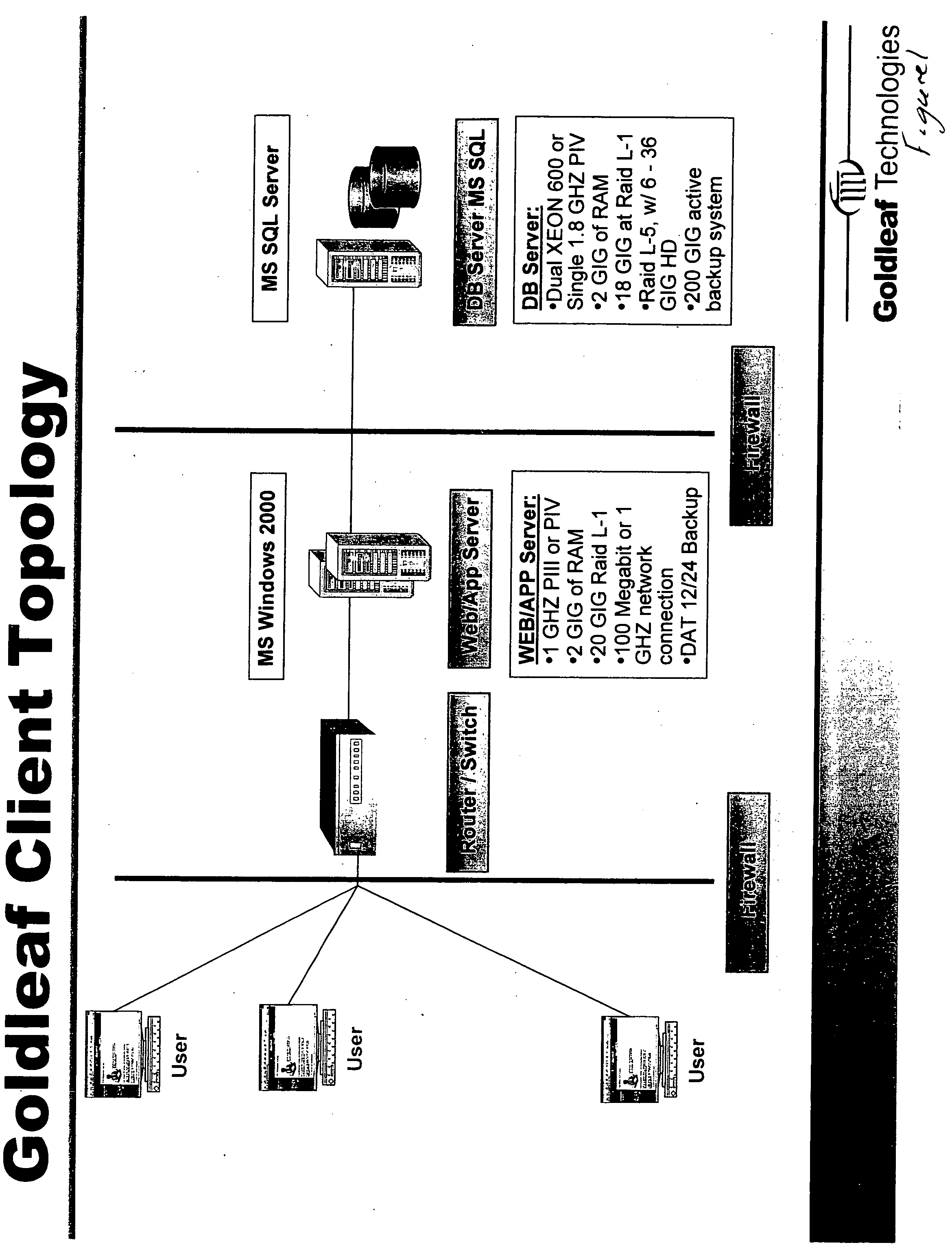

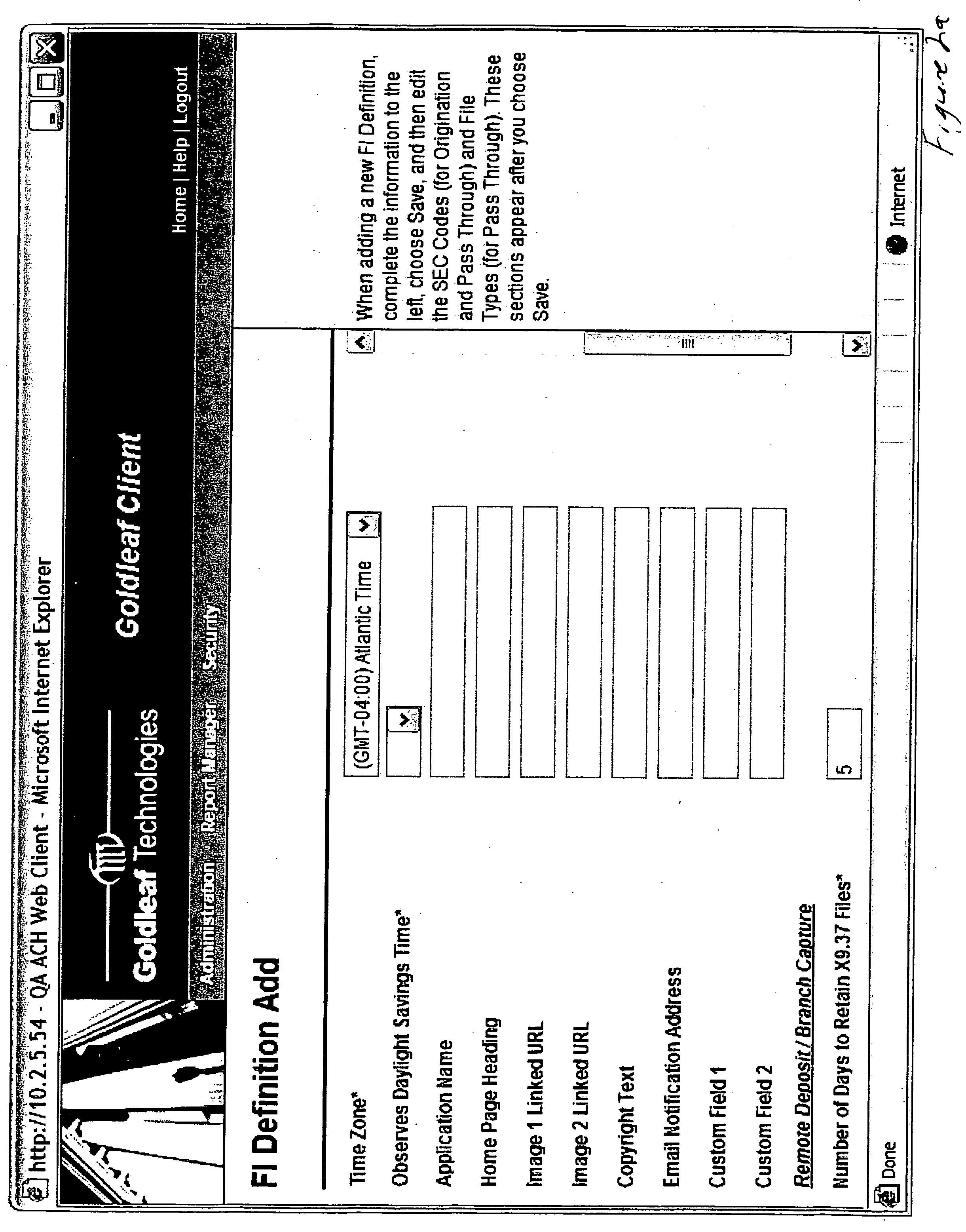

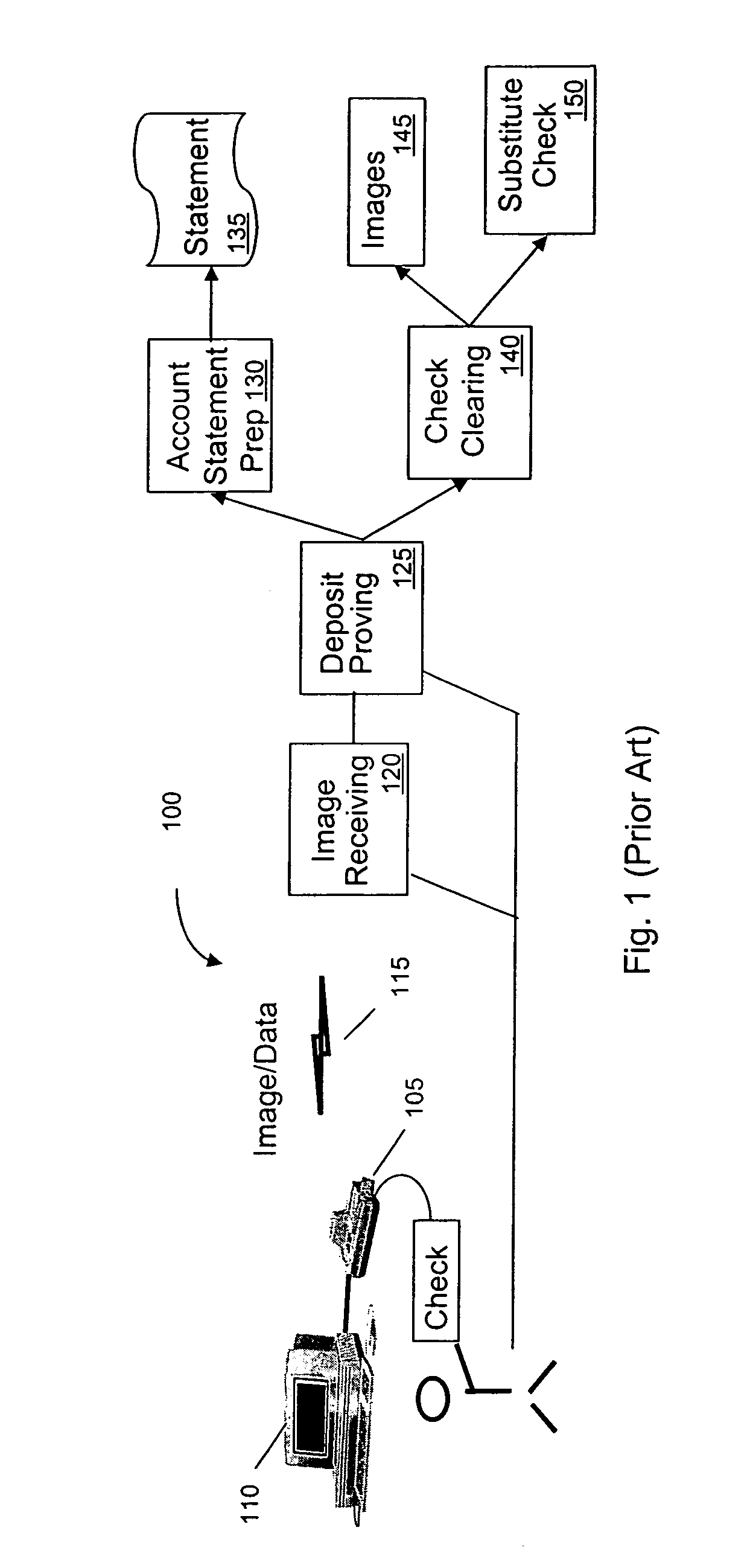

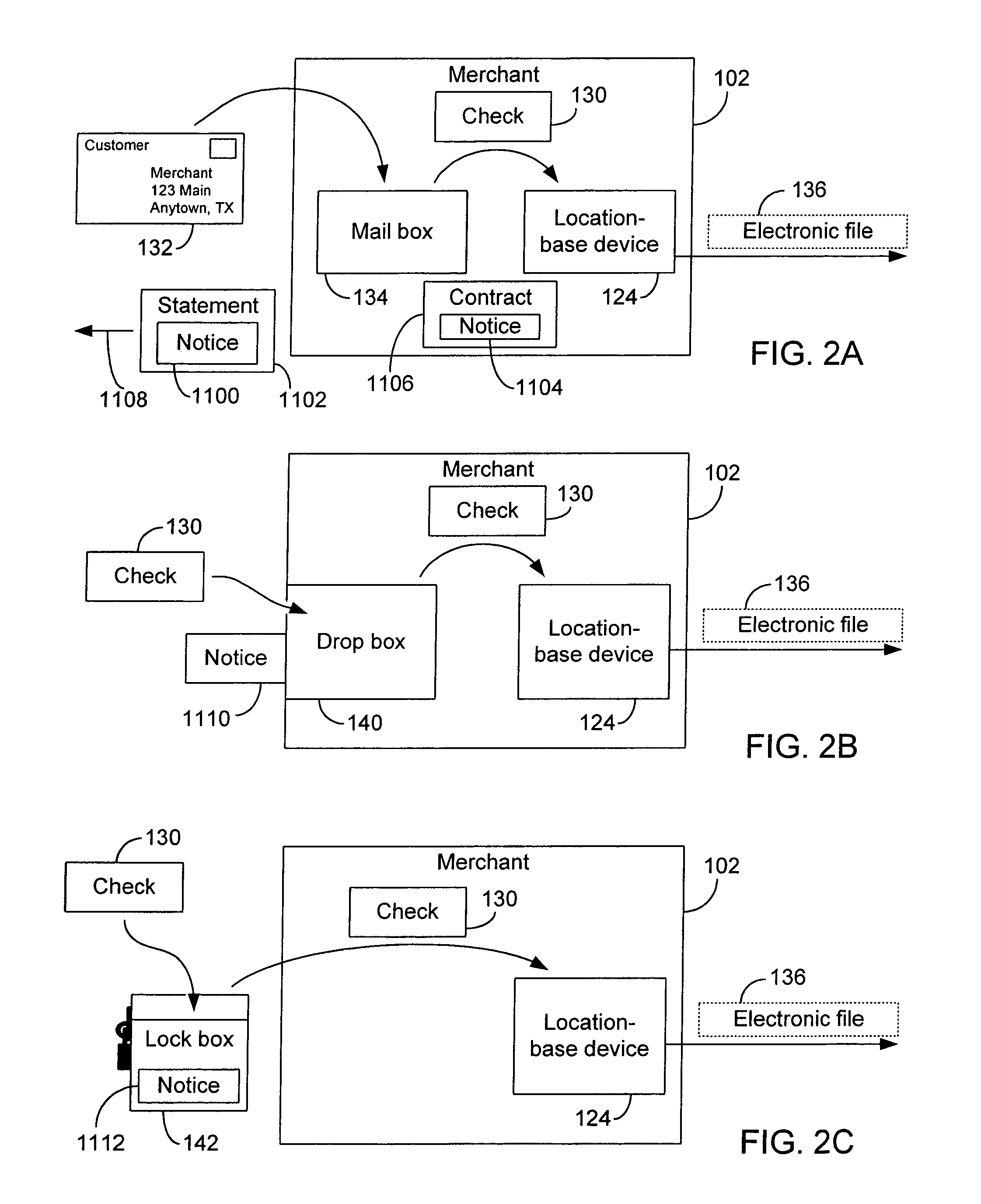

Remote check deposit

InactiveUS20060242062A1Easy to optimizeConvenient truncationFinancePayment circuitsDocumentation procedureSubstitute check

In accordance with the principles of the present invention, a system is provided for capturing a customer deposit at their place of business, converting the Magnetic Ink Character Recognition (MICR) data encoded documents into an image with an associated data file, and electronically transmit the data to a financial institution. The system allows the customer to scan each MICR encoded check that is to deposited with their financial institution, which captures financial institution routing information and customer account information. The associated image the physical check can be franked denoting the check has been electronically processed to avoid further processing. The resulting image and account data can then be processed by the financial institution. There are three options for encoding the amount: 1) the customer enters each amount after scanning the item prior to sending to the financial institution; 2) the financial institution enters the amount of each item after receiving the file from the customer; and 3) the amount field(s) are scanned and the amount is automatically entered. The system allows for both 1) online (Internet) capture of the MICR data and the associated image or 2) offline capture and the subsequent importing of the image and MICR data for transmission to the financial institution via the Internet. The financial institution can review the items captured online, and repair any item that is incorrect. The financial institution can use the system to print substitute checks that confirm to ANSI X9.90 for processing or deliver an electronic file in ANSI X9.37 format to any check processing system. The system includes secure transport over Internet connections for file transfer and dual control security to reduce fraudulent transactions from being initiated by the customer.

Owner:GOLDLEAF TECH

Ubiquitous imaging device based check image capture

Owner:LIGHTHOUSE CONSULTING GROUP

Processing apparatus, system and method for processing checks in communication with a host computer and a host computer for controlling the check processing apparatus

ActiveUS20050127160A1Character and pattern recognitionSpecial data processing applicationsParallel computingCheque

Processing apparatus, system and method for processing checks in communication with a host computer for accurately detecting check multifeeding. The check processing system includes a check processing apparatus and a host computer in communication with the check processing apparatus. The check processing apparatus acquires and sends check information from a check S to the host computer, and then pauses check processing. Based on the received check information, the host computer confirms whether checks are multifeeding in the check processing apparatus. If multifeeding is detected, a print command is sent to the check processing apparatus to print to the check S. The check processing apparatus prints an endorsement or a transaction record on the back of the check S only after this print command is received.

Owner:SEIKO EPSON CORP

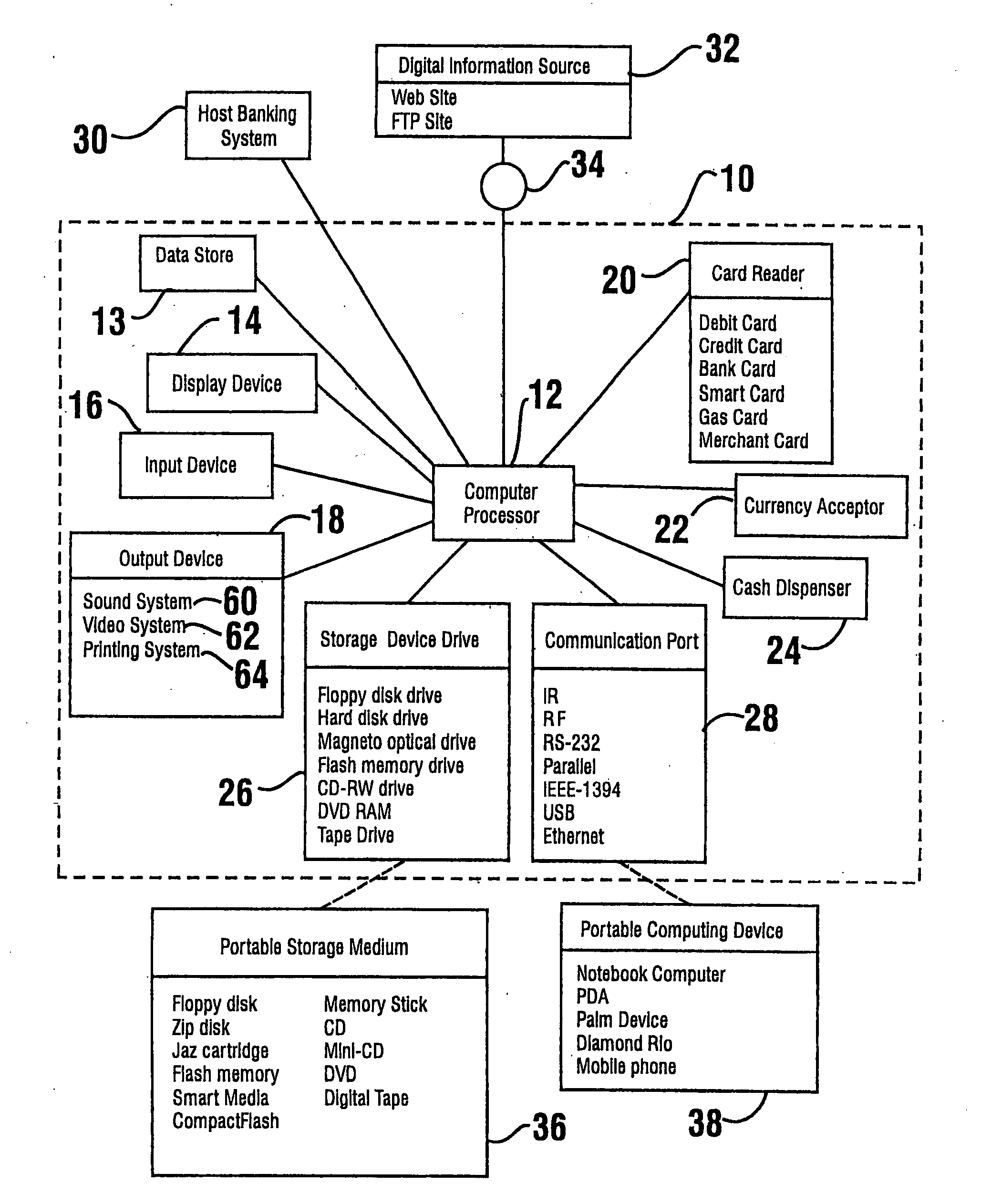

Automated banking machine system and method

A card actuated automated banking machine (152, 198, 200) includes a plurality of transaction function devices. The transaction function devices include a card reader (170), a printer (174), a bill dispenser (176), a coin dispenser (178), a display (182), a check imaging device (186) and at least one processor (190). The automated banking machine is operative responsive to receiving a check and certification data to dispense cash in exchange for the check. The person presenting the check need not provide user identifying inputs through input devices in order to receive cash for the check. A check recipient prior to presenting the check for payment is also enabled to verify that the check will be paid through communication with at least one computer (204) through at least one consumer interface device (208).

Owner:DIEBOLD SELF SERVICE SYST DIV OF DIEBOLD NIXDORF INC

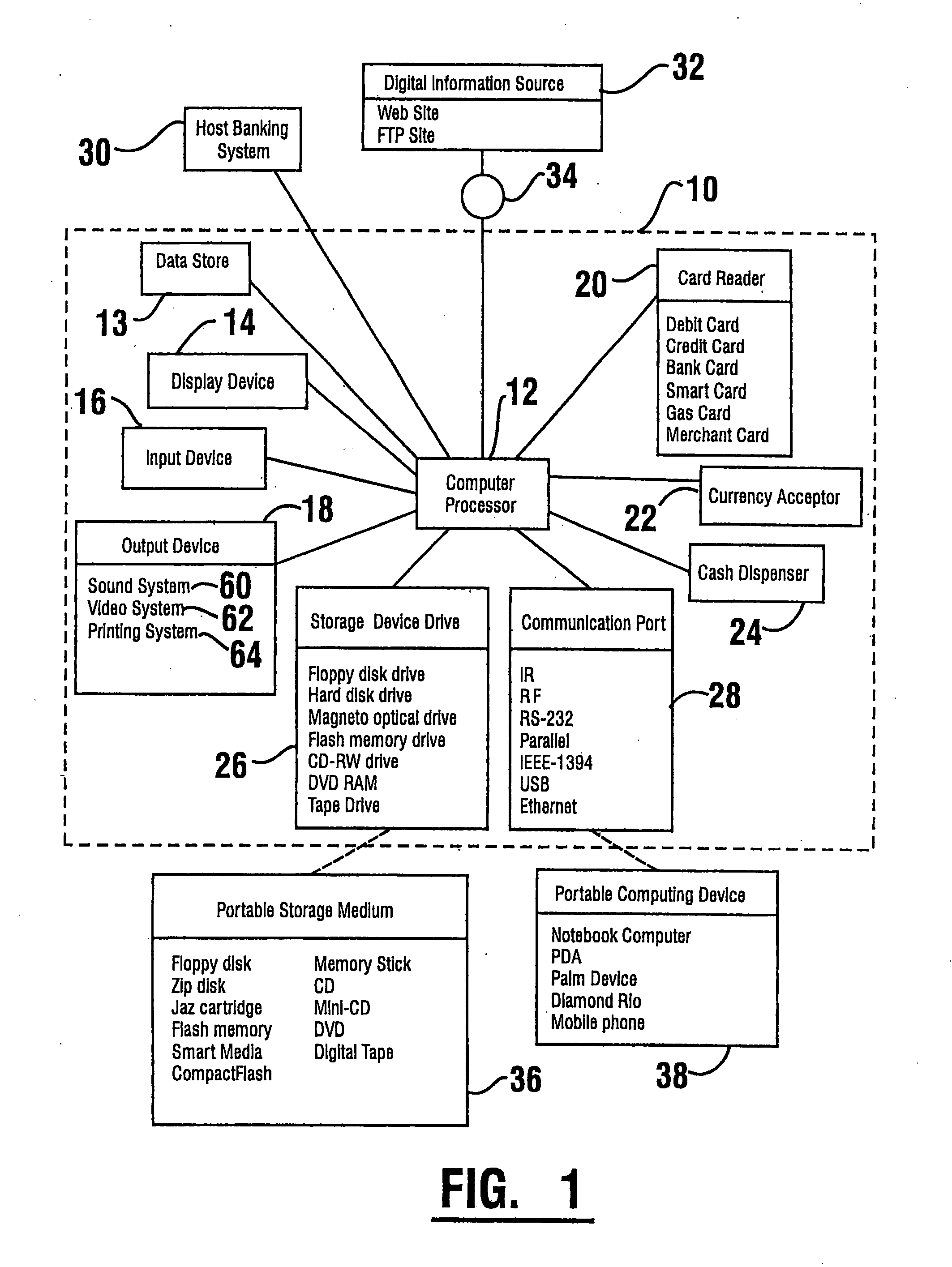

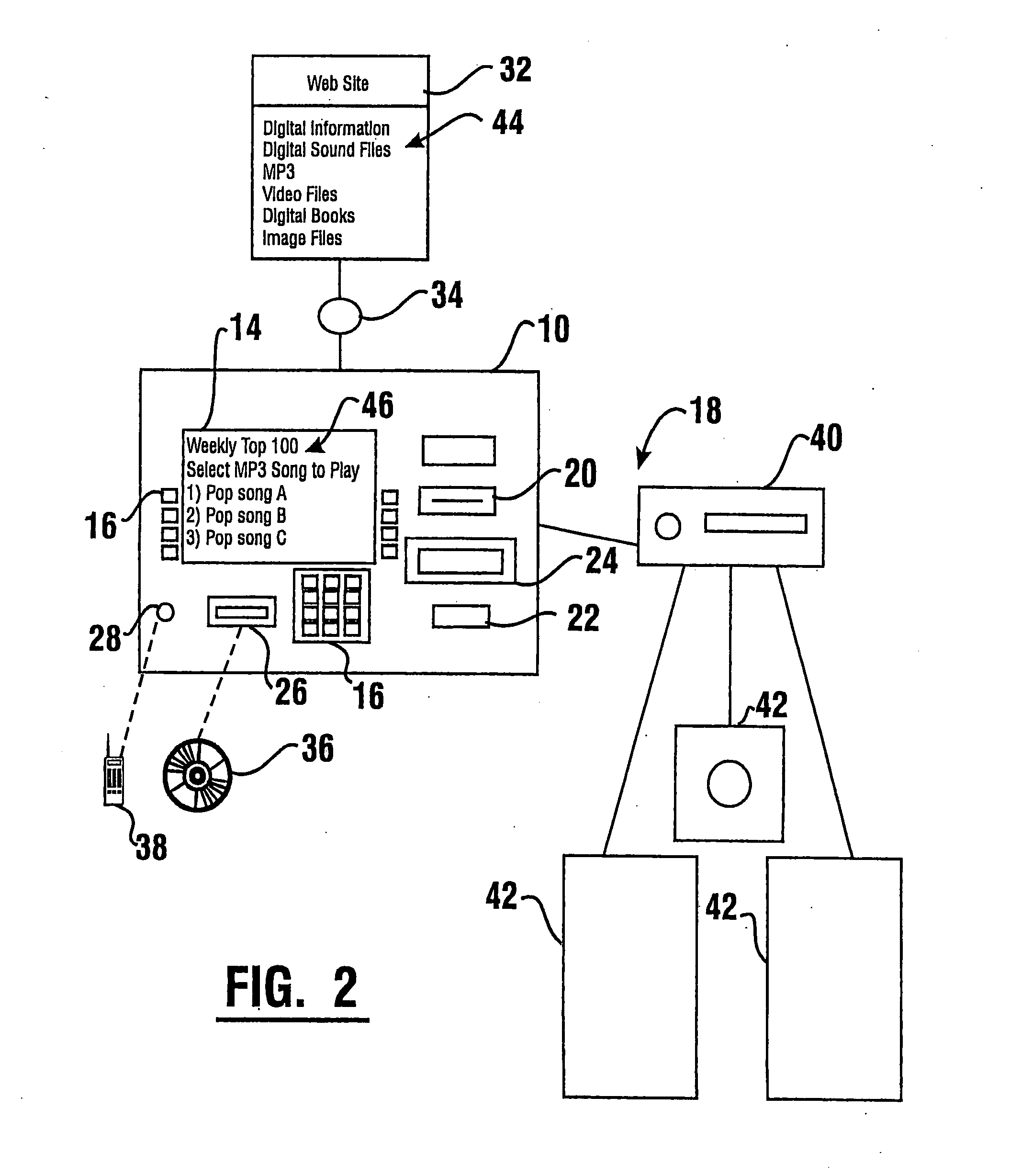

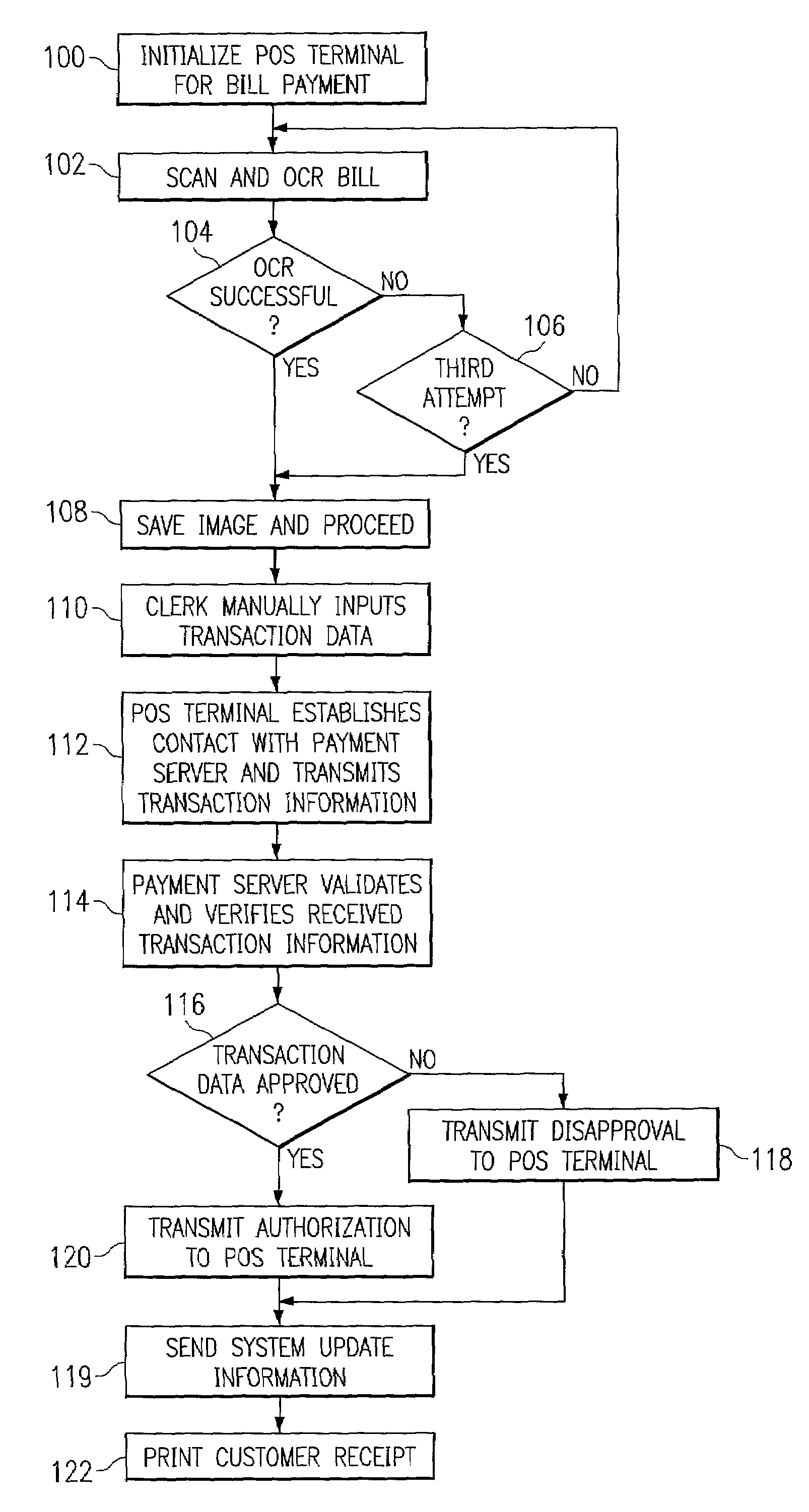

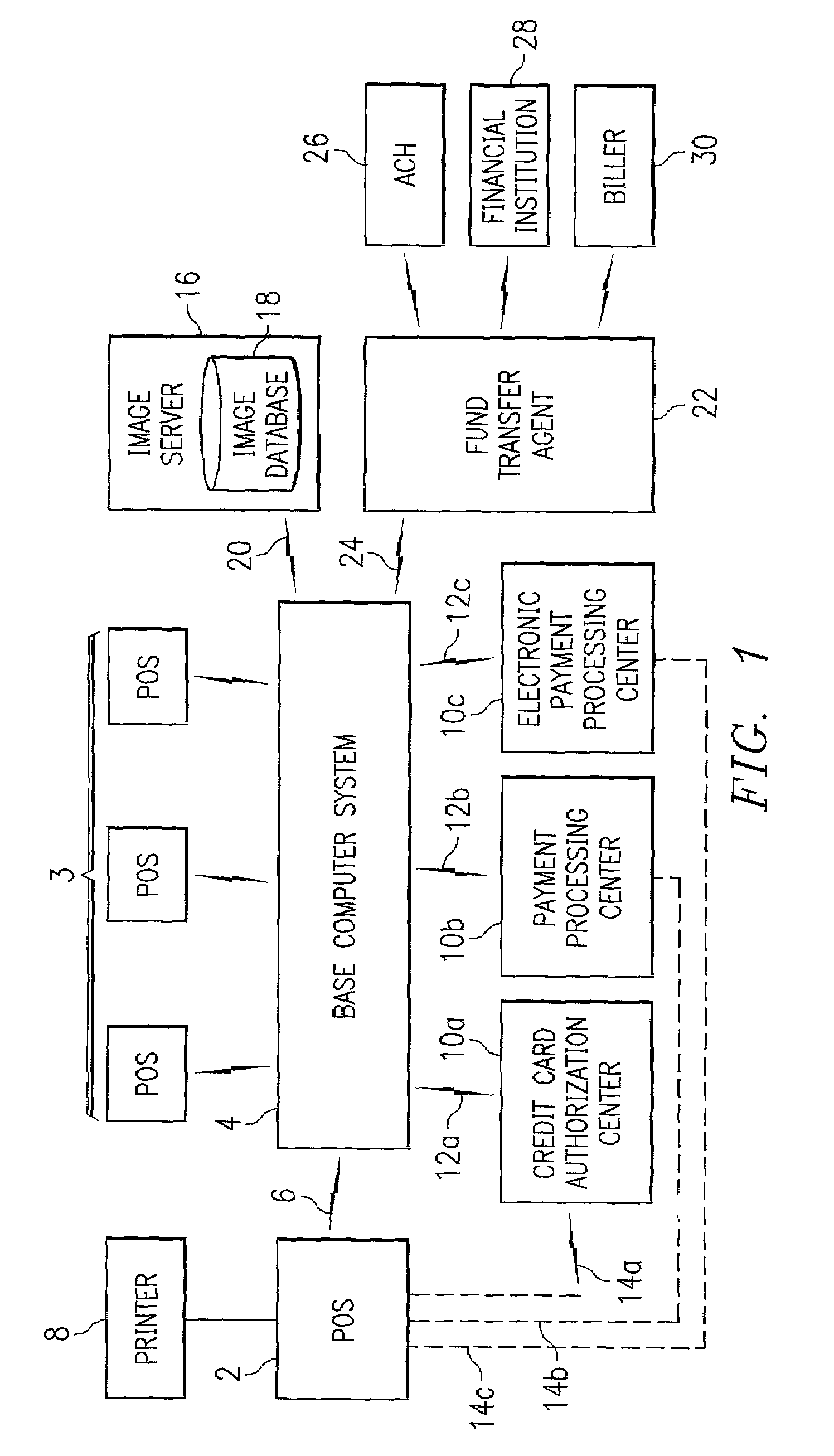

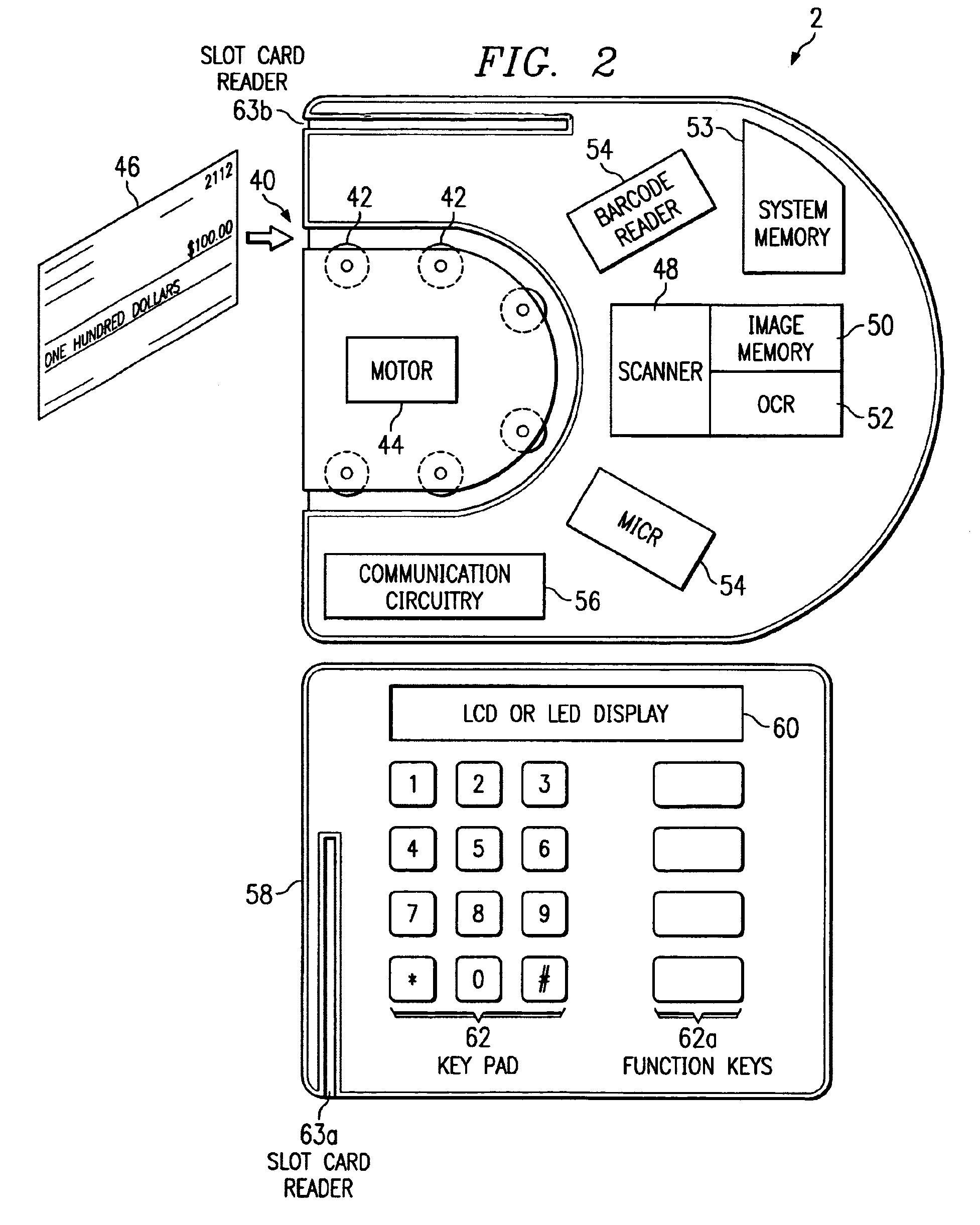

Method and apparatus for electronic commerce services at a point of sale

Point of sale transactions can be efficiently processed by use of a point of sale terminal having both image capture and storage capability, as well as other information input capabilities such as a MICR reader, a bar code reader, a keyboard, or similar input device. The system stores an image of the actual transaction documents, such as the bill to be paid and the check by which payment is made, for future reference and verification. In this way, paper copies of the bill need not be archived, and the check can be processed by electronic check conversion, further lowering costs. The electronic transaction information, such as biller identification, account number, payment made, and the like is forwarded from the POS location to a central data processing center in real time and authorization or denial of authorization to accept payment is returned to the POS terminal in real time. Additionally, system updates such as authorized billers, service fee schedules, and the like can be updated in real time, each time a transaction is transmitted from or to the POS terminal. Another advantageous feature is that a single POS terminal can be configured to communicate with multiple service providers and hence accommodate multiple different types of transactions such as issuing money orders, gift certificates, official checks, payroll checks, check cashing, bill paying, credit card authorization, age verification, and the like.

Owner:GSC ENTERPRISES

Currency bill and coin processing system

A system for processing currency and other media includes a compact currency bill processing device, a coin scale, and a controlling device. The compact currency bill processing device is adapted to count and determine the denomination of currency bills received in an input receptacle and transported, one bill at a time, to at least one output receptacle. The coin scale adapted to receive and determine a coin total for at least one group of coins of a single denomination. The controlling device is communicatively coupled to the currency bill processing device and the coin scale, and includes an integrated keypad and printer. The keypad is adapted to manually receive information from an operator, and the printer is adapted to print a hardcopy of information associated with the currency bills, the coins, and other media.

Owner:CUMMINS-ALLISON CORP

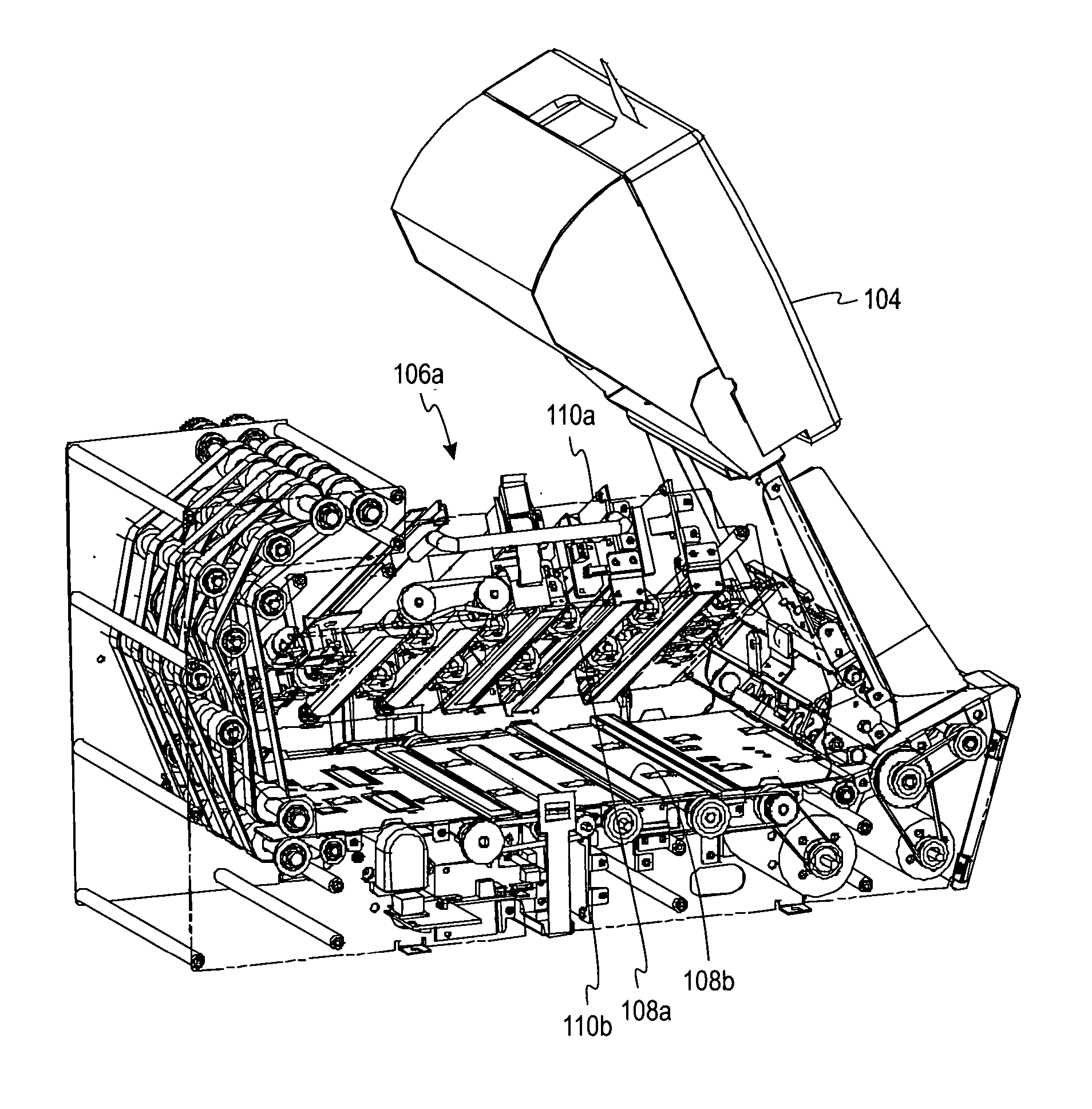

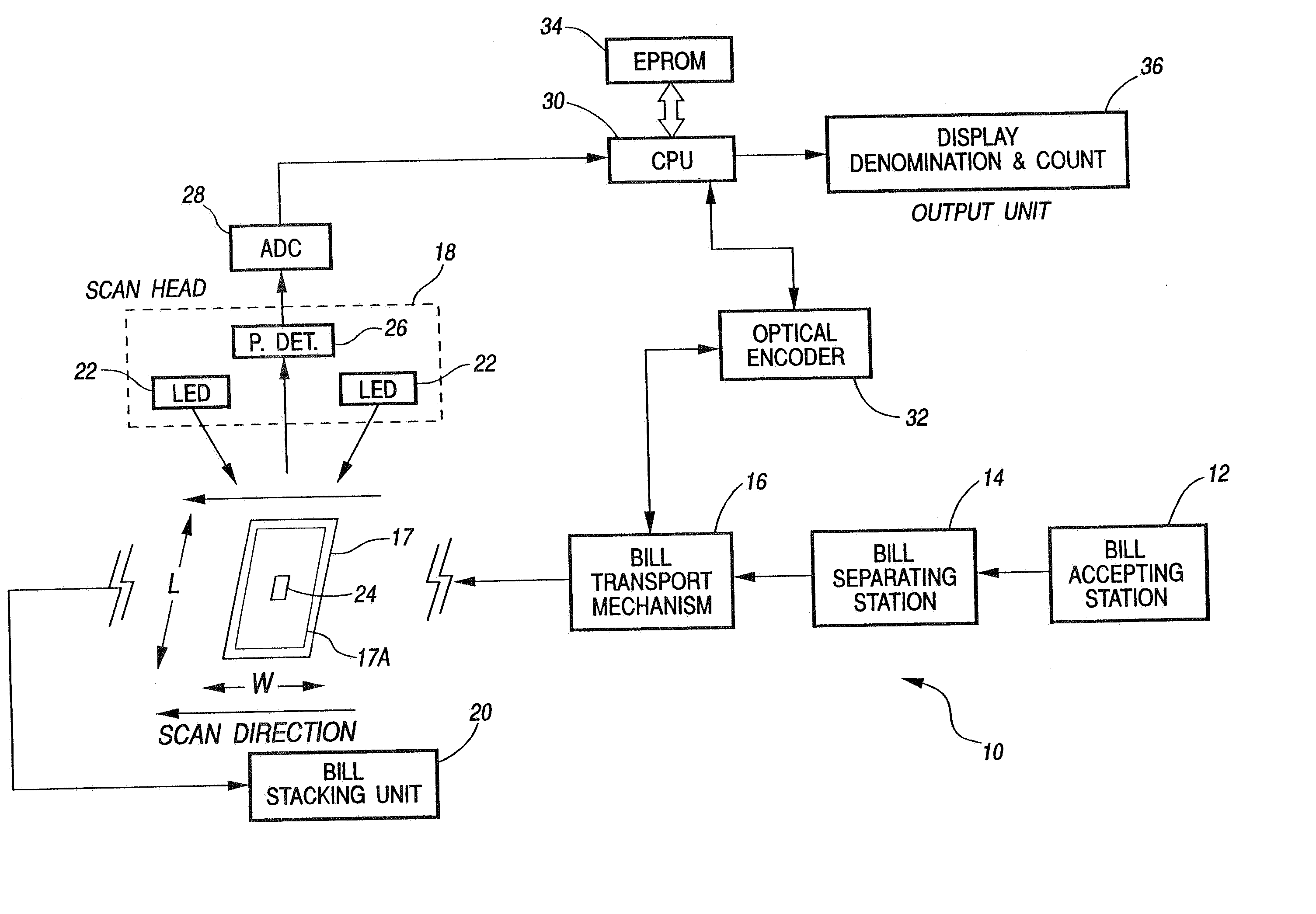

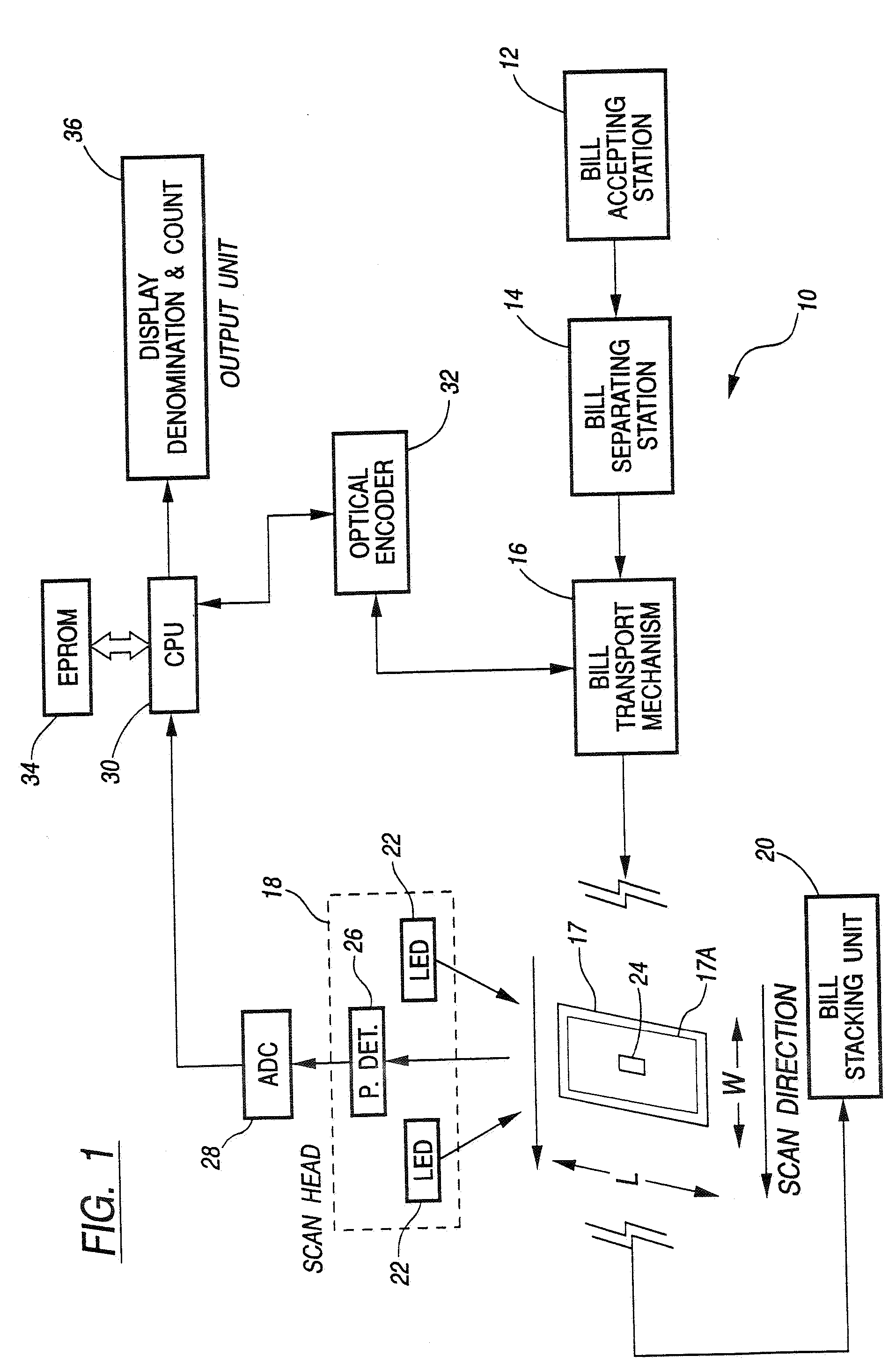

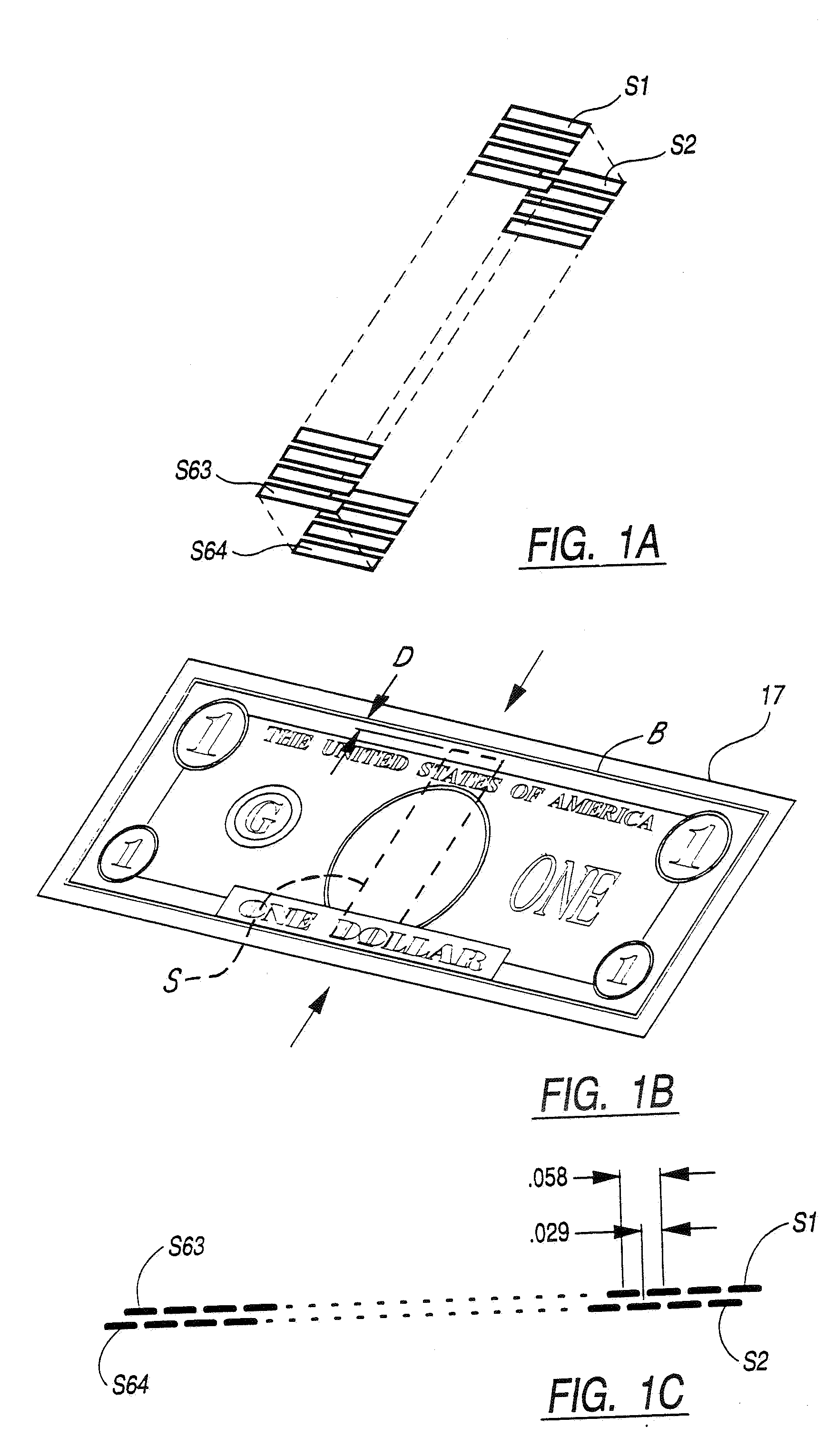

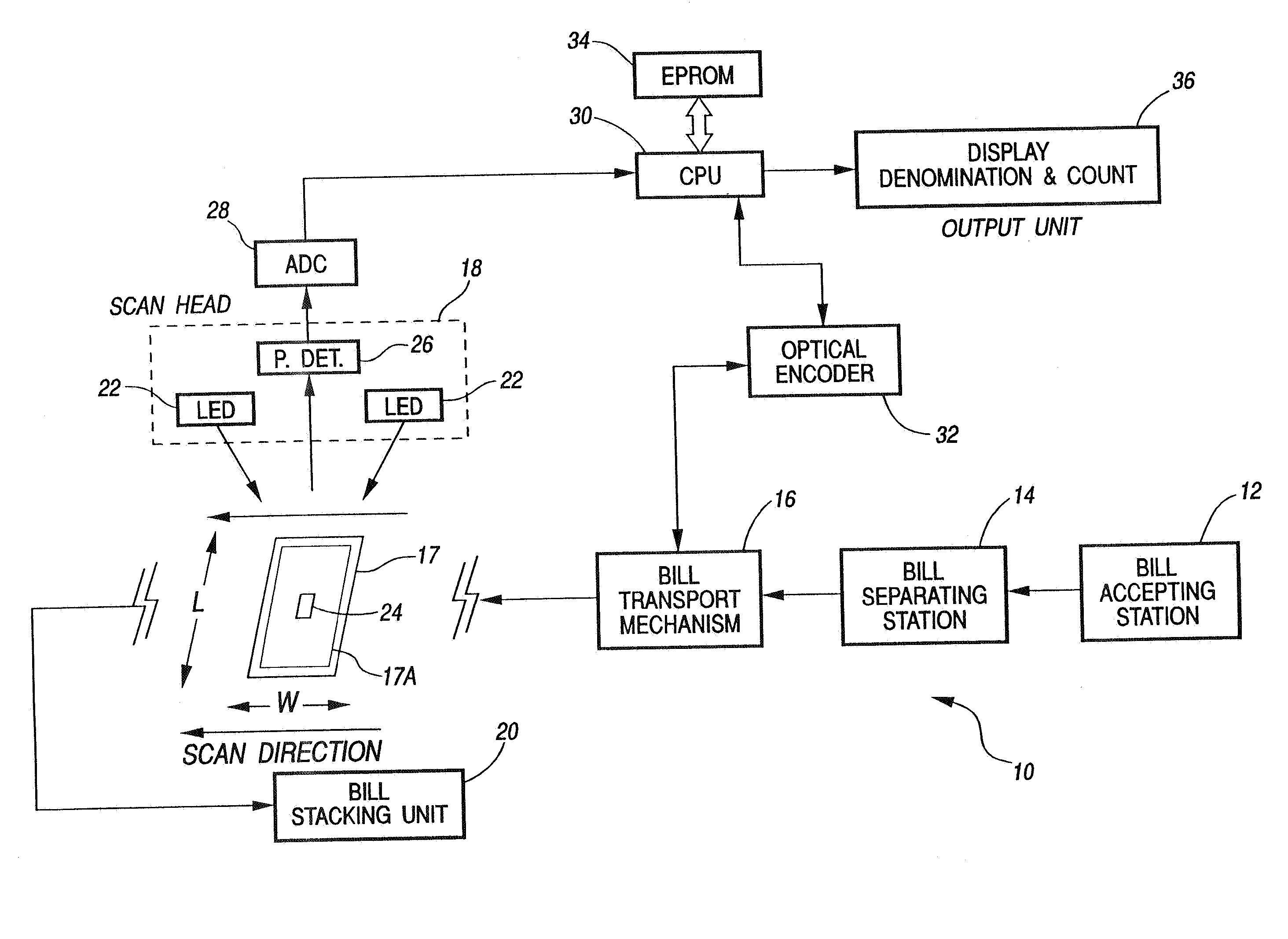

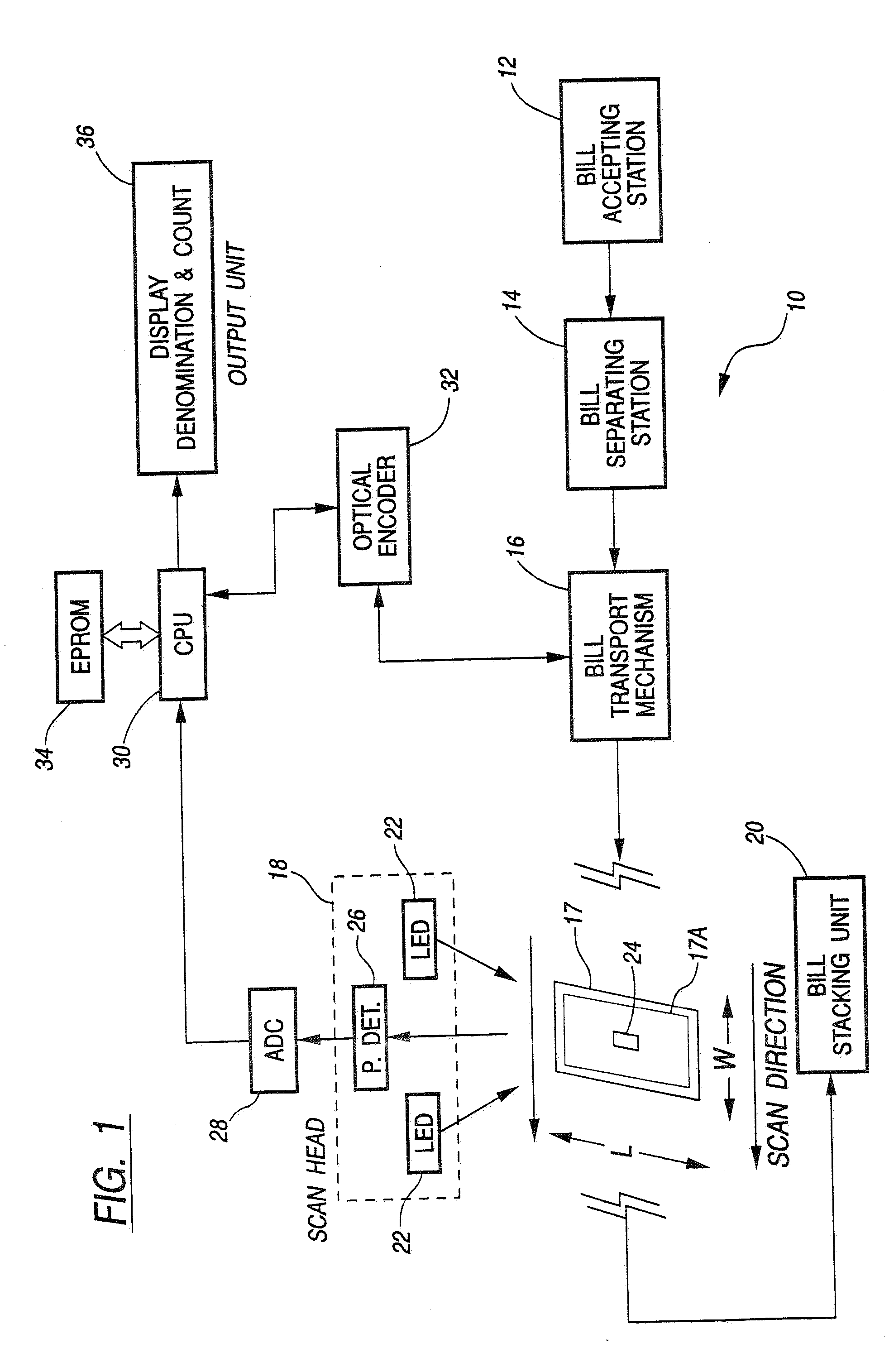

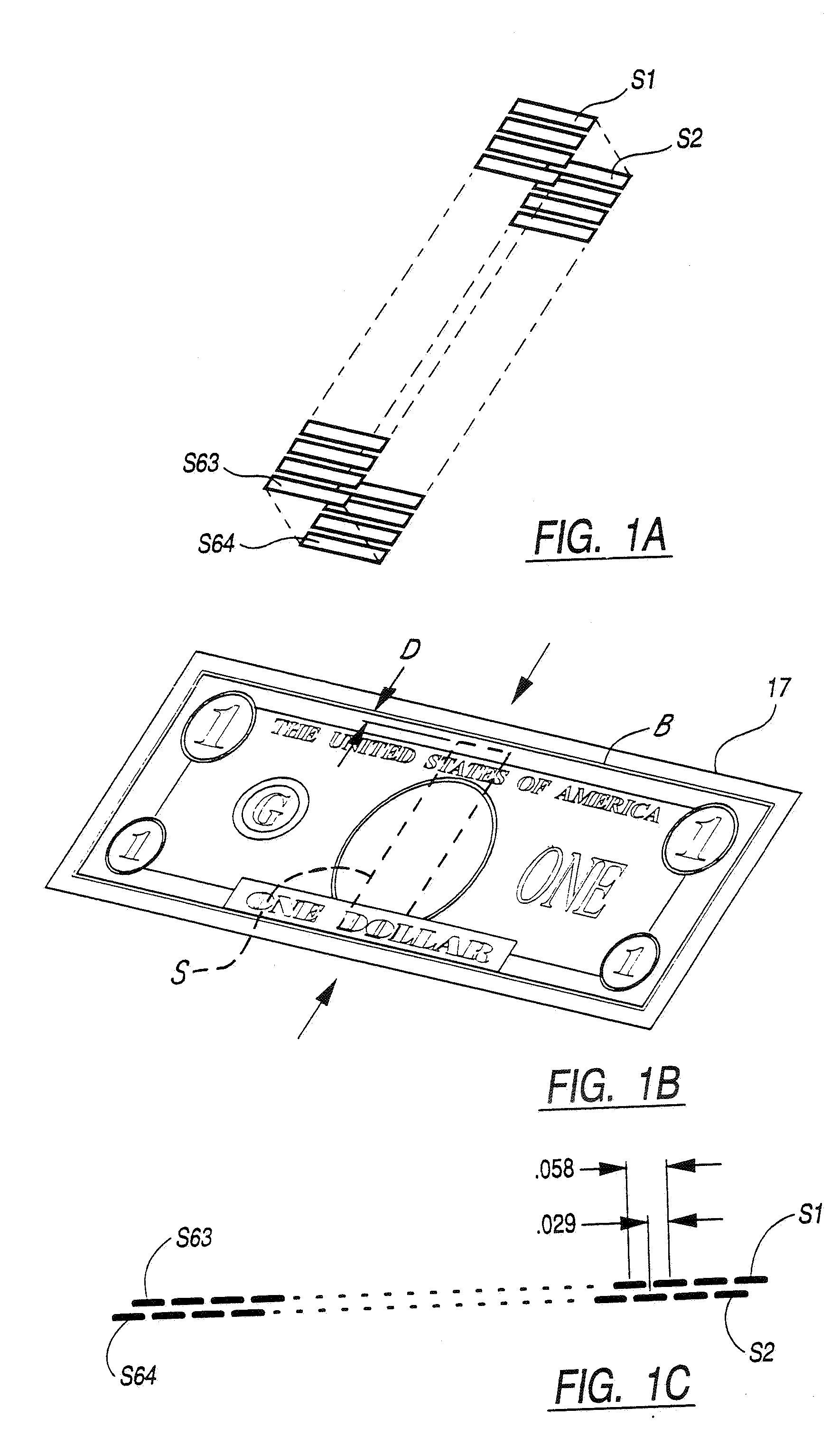

Method and apparatus for discriminating and counting documents

InactiveUS6980684B1Efficient countingEfficient discriminationCoin/currency accepting devicesCharacter and pattern recognitionEngineeringIdentification device

Owner:CUMMINS-ALLISON CORP

Systems and methods for performing transactions at a point-of-sale

A point-of-sale device useful in relation to a variety of circumstances and / or utilization methods. Various implementations of such point-of-sale devices are disclosed. For example, one particular point-of-sale device includes a base unit adapted for performing merchant functions and a peripheral unit adapted to perform customer functions. The base unit can include a base unit housing with a processor disposed therein and capable of supporting a variety of transaction types.

Owner:FIRST DATA +1

Method and apparatus for currency discrimination

InactiveUS20050117792A2Efficient countingEfficient discriminationComplete banking machinesImage analysisEngineeringStacker

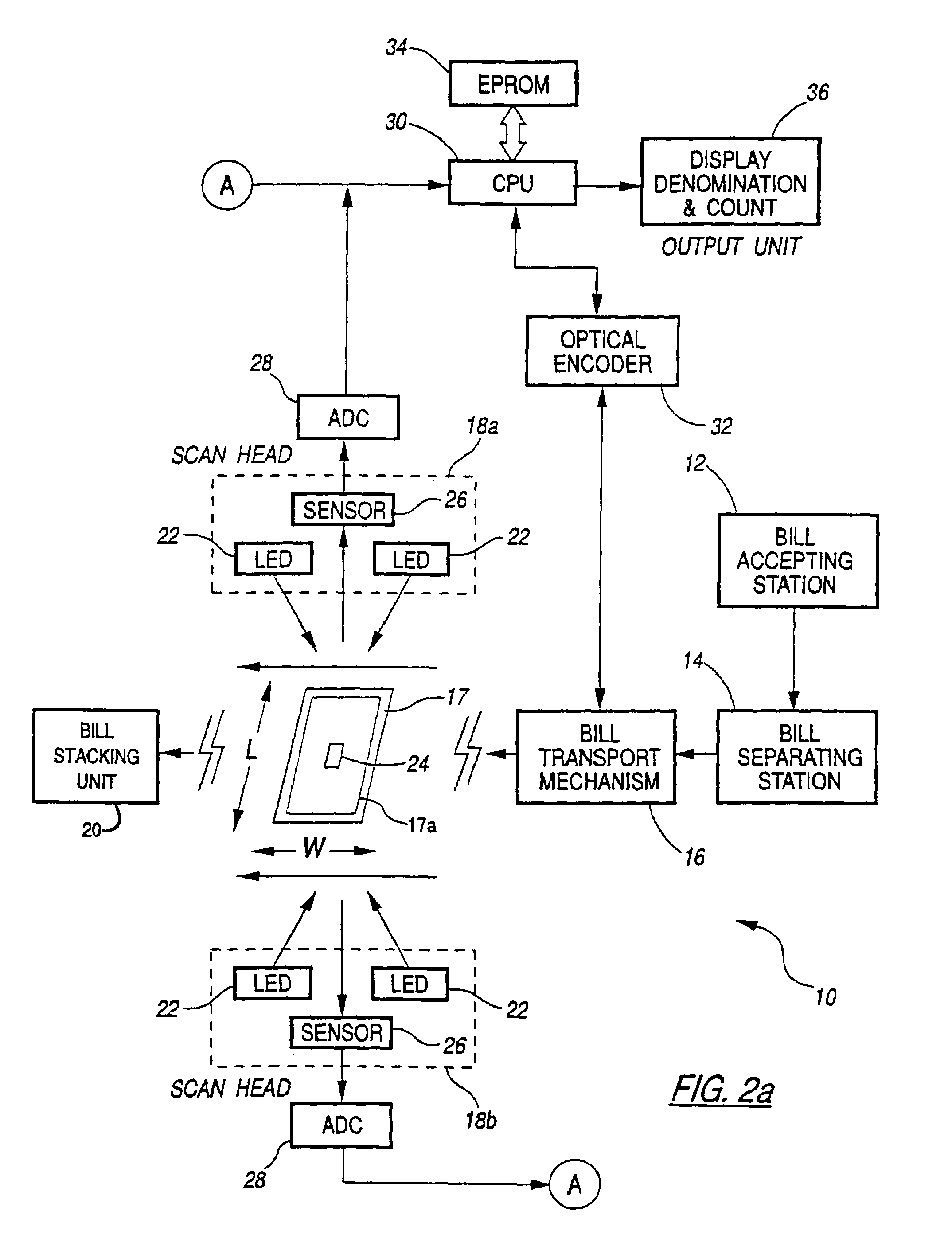

Abstract of the DisclosureA currency evaluation device for receiving a stack of U.S. currency bills and rapidly evaluating all the bills in the stack comprises an input receptacle adapted to receive a stack of U.S. currency bills of a plurality of denominations to be evaluated. According to one embodiment, a transport mechanism transports the bills, one at a time, from the input receptacle along a transport path at a rate of at least about 800 bills per minute. A denomination discriminating unit which includes a detector positioned along the transport path evaluates the bills. The device comprises a single denominated bill output receptacle positioned to receive bills whose denomination have been determined by the discriminating unit including bills of a plurality of denominations. A separate stacker bin is provided and a diverter positioned along the transport path routes bills whose denomination cannot be determined to the separate stacker bin.

Owner:CUMMINS-ALLISON CORP

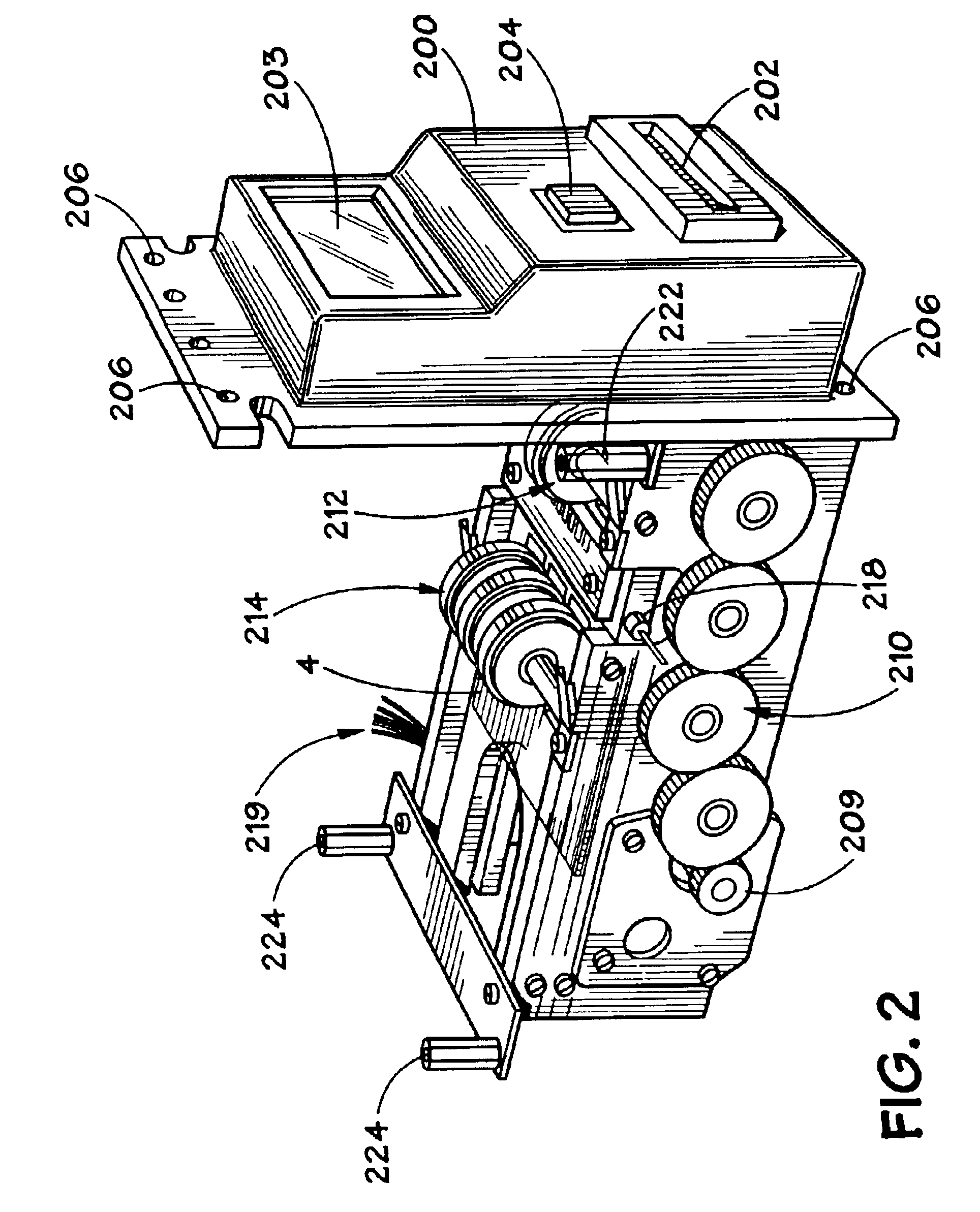

Method and apparatus for discriminating and counting documents

InactiveUS6915893B2Simple and compactEasy to usePaper-money testing devicesCoin/currency accepting devicesEngineeringMechanical engineering

A currency evaluation device for receiving a stack of currency bills and rapidly evaluating all the bills in the stack. The device includes an input receptacle for receiving a stack of bills to be evaluated and a single output receptacle for receiving the bills after they have been evaluated. A transport mechanism transports the bills, one at a time, from the input receptacle to the output receptacle along a transport path. The device further includes a discriminating unit that evaluates the bills. The discriminating unit comprises two detectors positioned along the transport path between the input receptacle and the output receptacle. The detectors are disposed on opposite sides of the transport path so that they are disposed adjacent to opposite sides of the bills. The discriminating unit counts and determines the denomination of the bills. The evaluation device also includes means for flagging a bill when the denomination of the bill is not determined by the discriminating unit.

Owner:CUMMINS-ALLISON CORP

Method and apparatus for currency discrimination

InactiveUS20050117791A2Efficient countingEfficient discriminationComplete banking machinesImage analysisEngineeringTelecommunications

Owner:CUMMINS-ALLISON CORP

Systems and methods for generating receipts

InactiveUS7520420B2Easy to processFacilitate the processComplete banking machinesFinanceProgramming languageCheque

Owner:FIRST DATA

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com