Check accepting and cash dispensing automated banking machine system and method

a technology of automatic banking machine and check, which is applied in the field of automatic banking machines, can solve the problems of user's frequent incurring a "bad check" fee, further delays, and possible problems, and achieve the effect of reducing the likelihood of interference with acceptance and minimizing the risk of damage to the printing mechanism or the check

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Benefits of technology

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

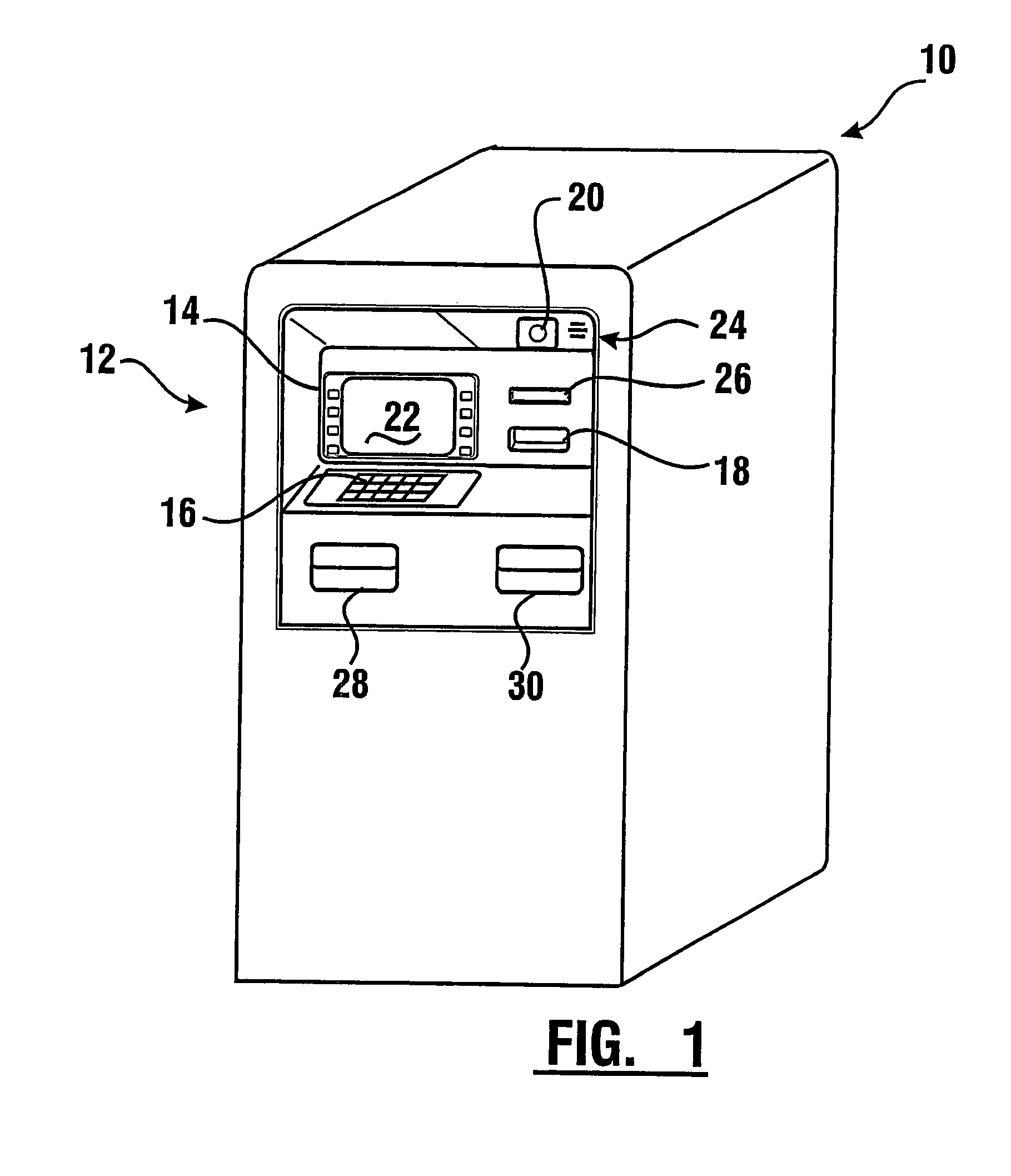

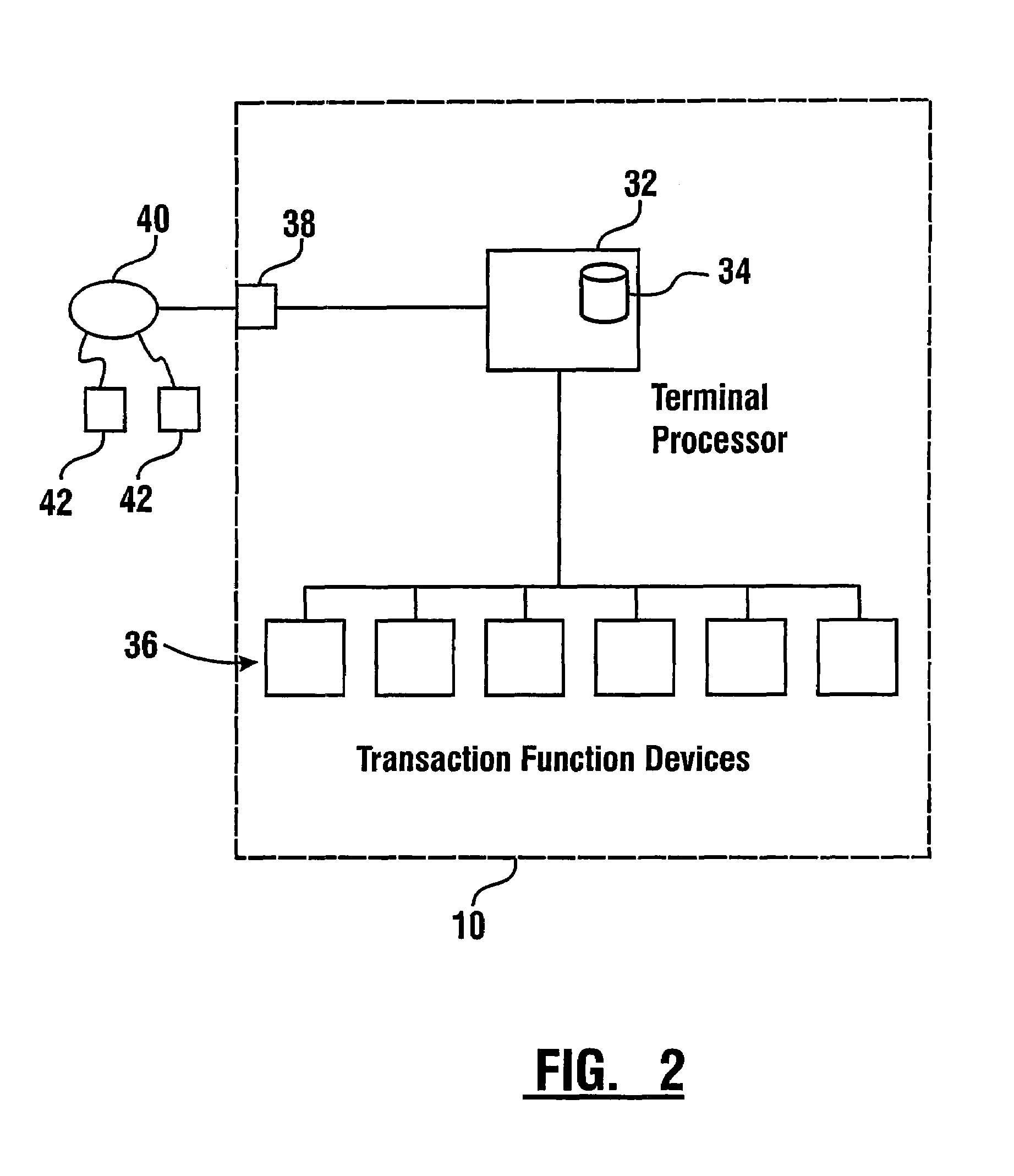

[0116]Referring now to the drawings and particularly to FIG. 1, there is shown therein an exemplary embodiment of an automated banking machine 10 which includes an exemplary deposit accepting apparatus and which performs an exemplary methods of operation. Automated banking machine 10 is an ATM. However it should be understood that the inventive concepts disclosed herein may be used in connection with various types of automated banking machines and devices of other types. Automated banking machine 10 includes a user interface generally indicated 12. User interface 12 includes input and output devices. In the exemplary embodiment the input devices include a plurality of function buttons 14 through which a user may provide inputs to the machine. The exemplary input devices further include a keypad 16 through which a user may provide numeric or other inputs. A further input device in this exemplary embodiment includes a card reader schematically indicated 18. Card reader 18 may be of th...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com