Patents

Literature

615results about "ATM surveillance" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

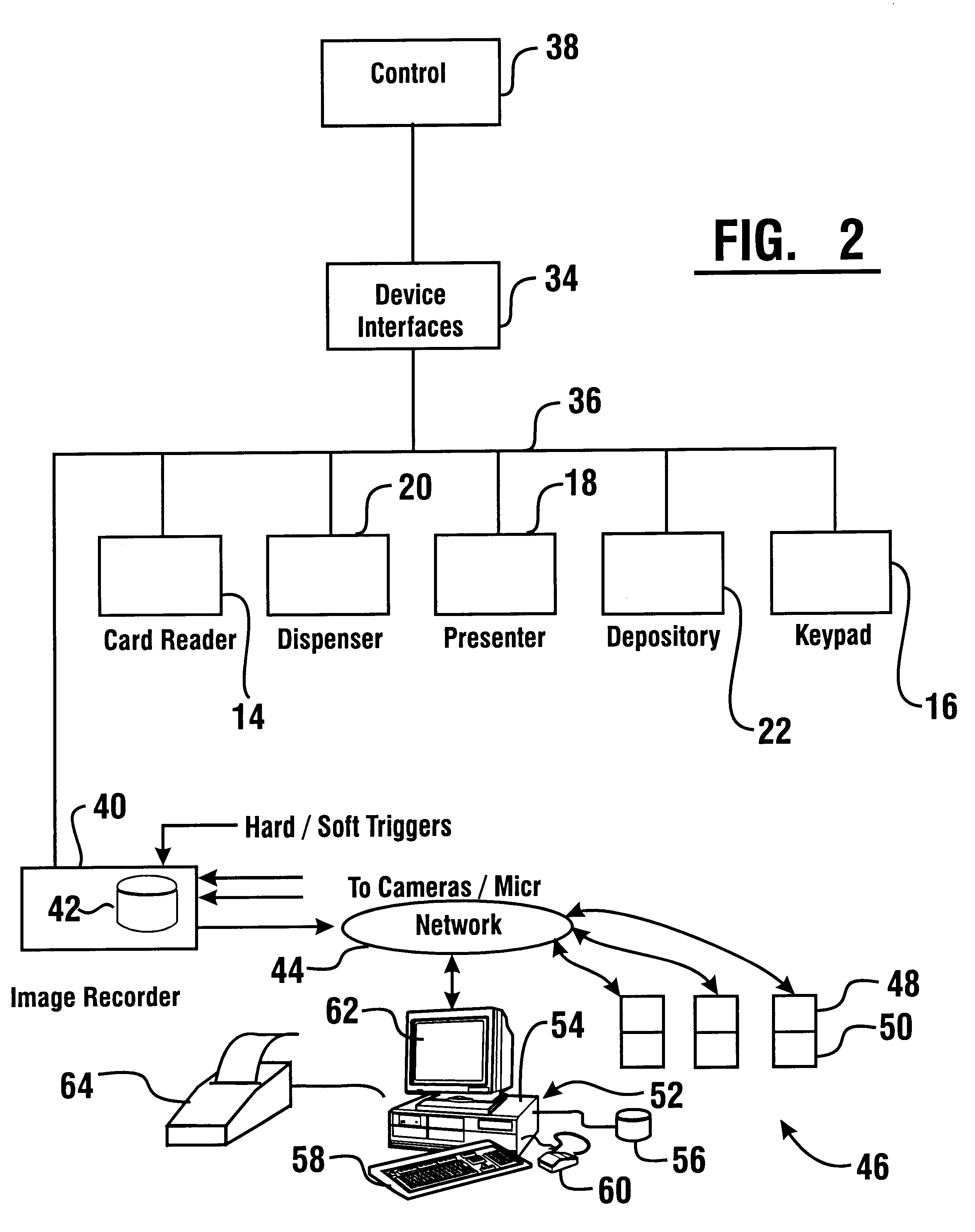

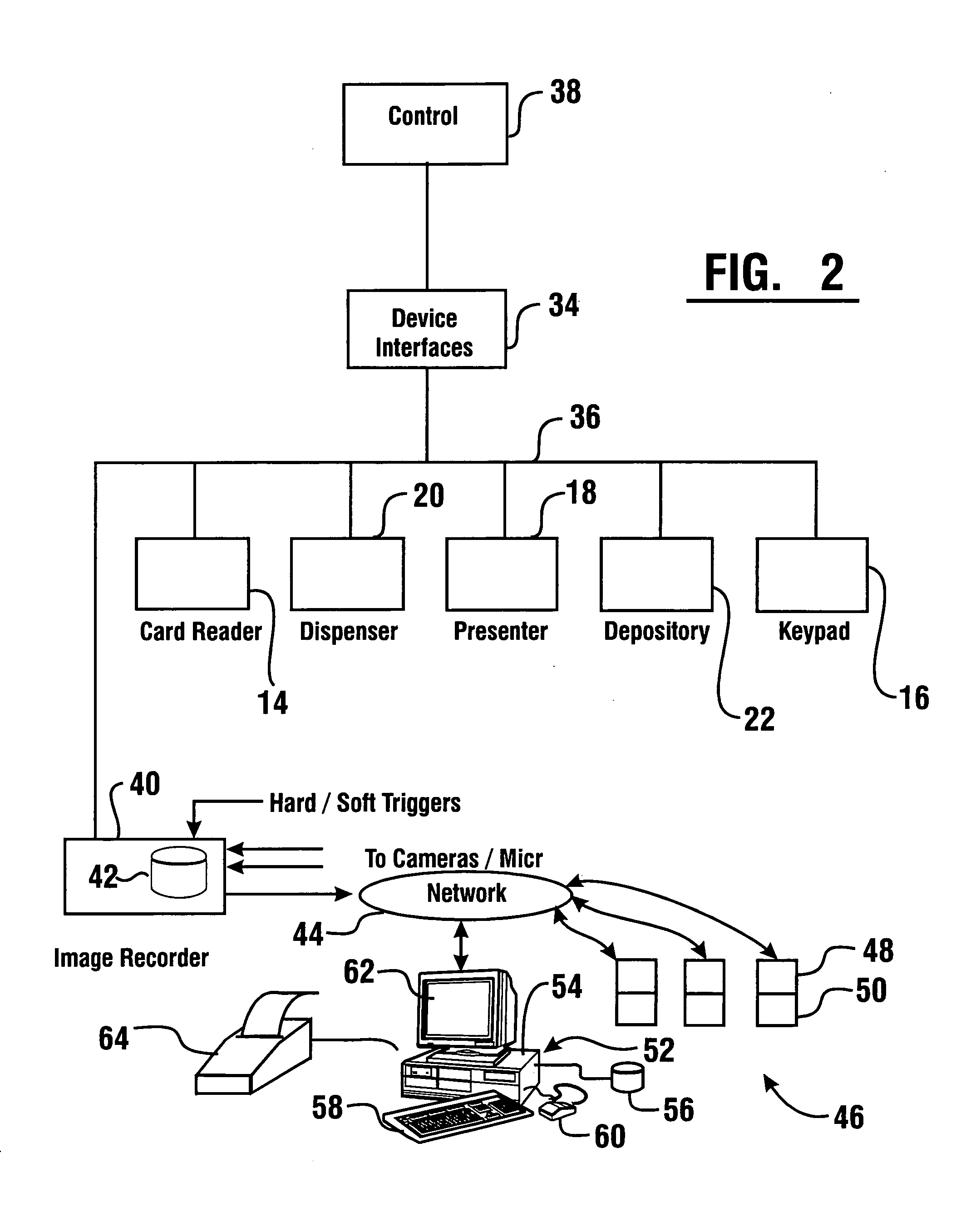

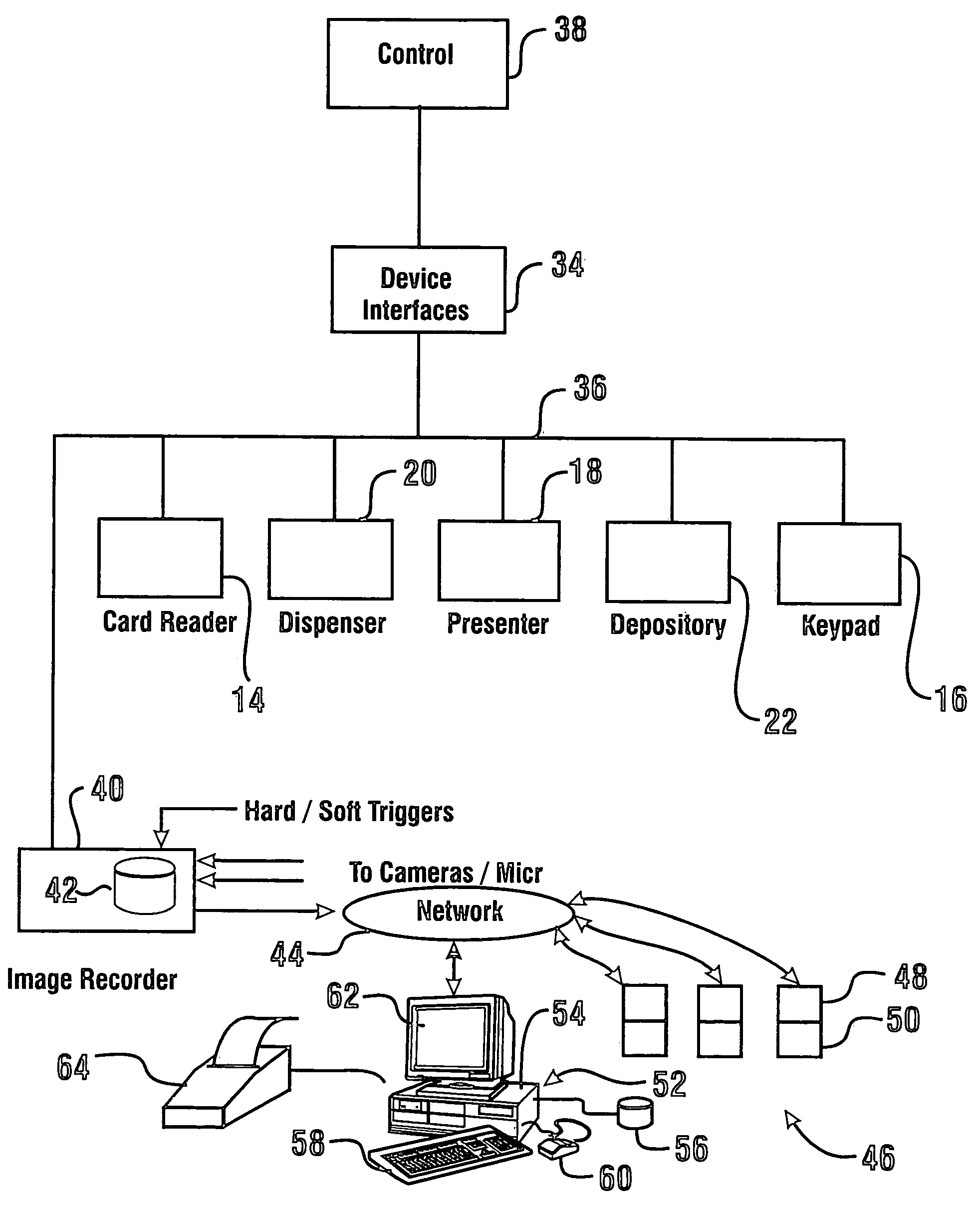

System and method for capturing and searching image data associated with transactions

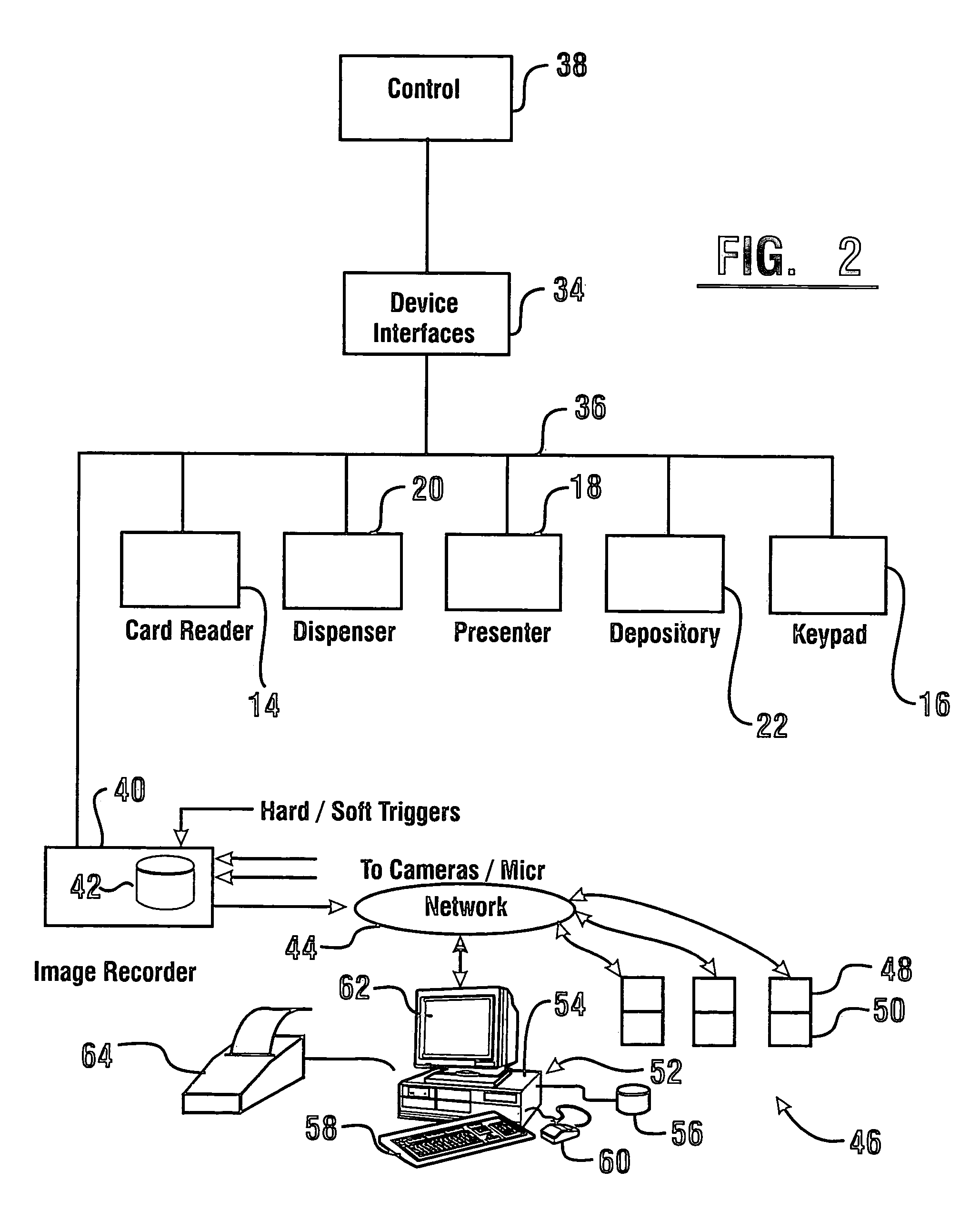

InactiveUS6583813B1Programmed more readilyEasy programmingComplete banking machinesColor television detailsImaging conditionEvent type

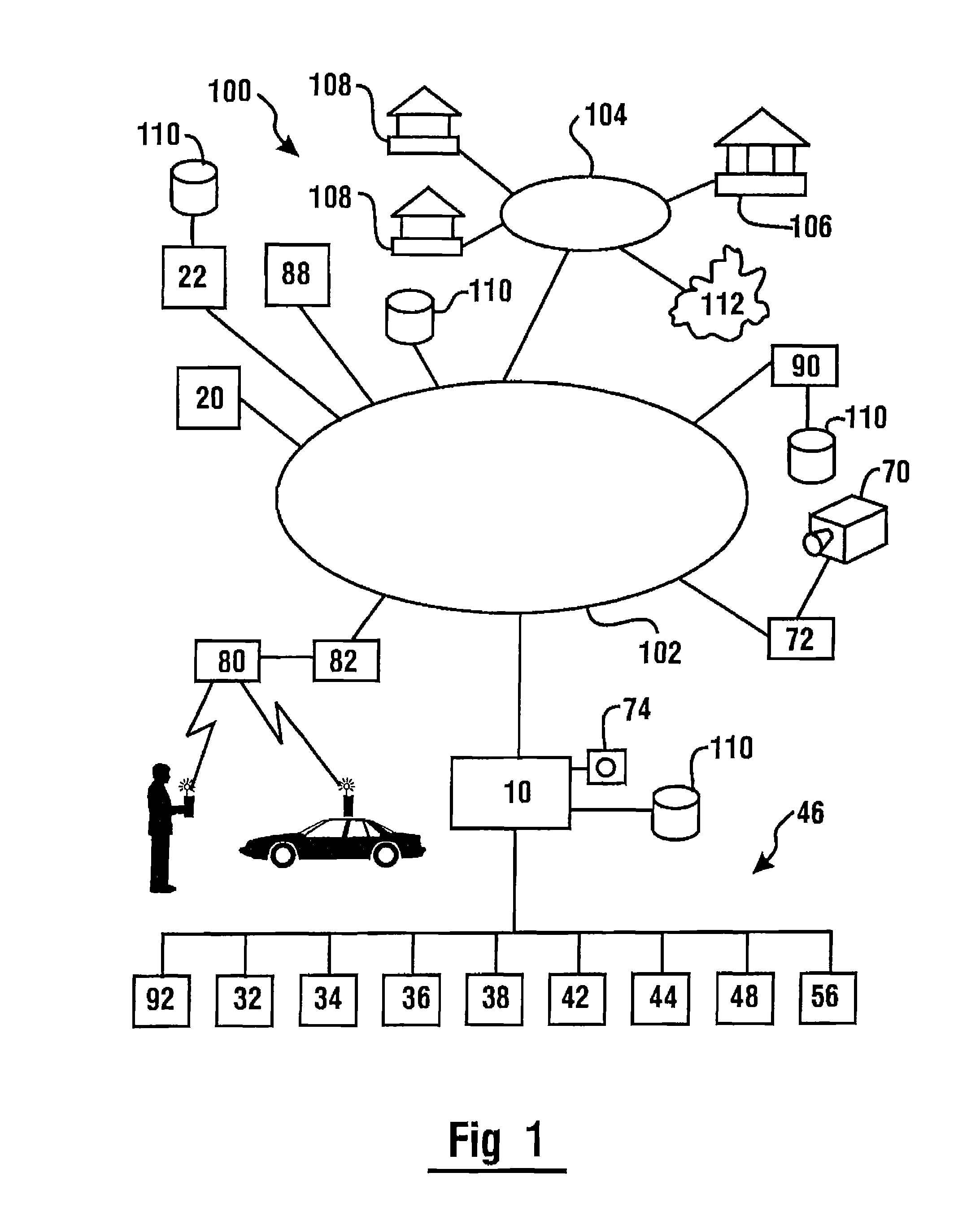

A system and method for capturing image data captures images responsive to programmed sequences. The sequences are performed on a periodic basis as well as in response to inputs corresponding to alarm conditions and transactions conducted at automated banking machines or other devices. Image data may also be captured in response to image conditions including the sensing of motion or the loss of usable video from selected cameras. Image data is stored in connection with data corresponding to circumstances associated with each triggering event. Stored image data may be searched by one or more parameters. Parameters include data stored in association with each image, types of events causing image data to be stored, as well as other image conditions in stored images.

Owner:SECURITAS ELECTRONICS SECURITY INC

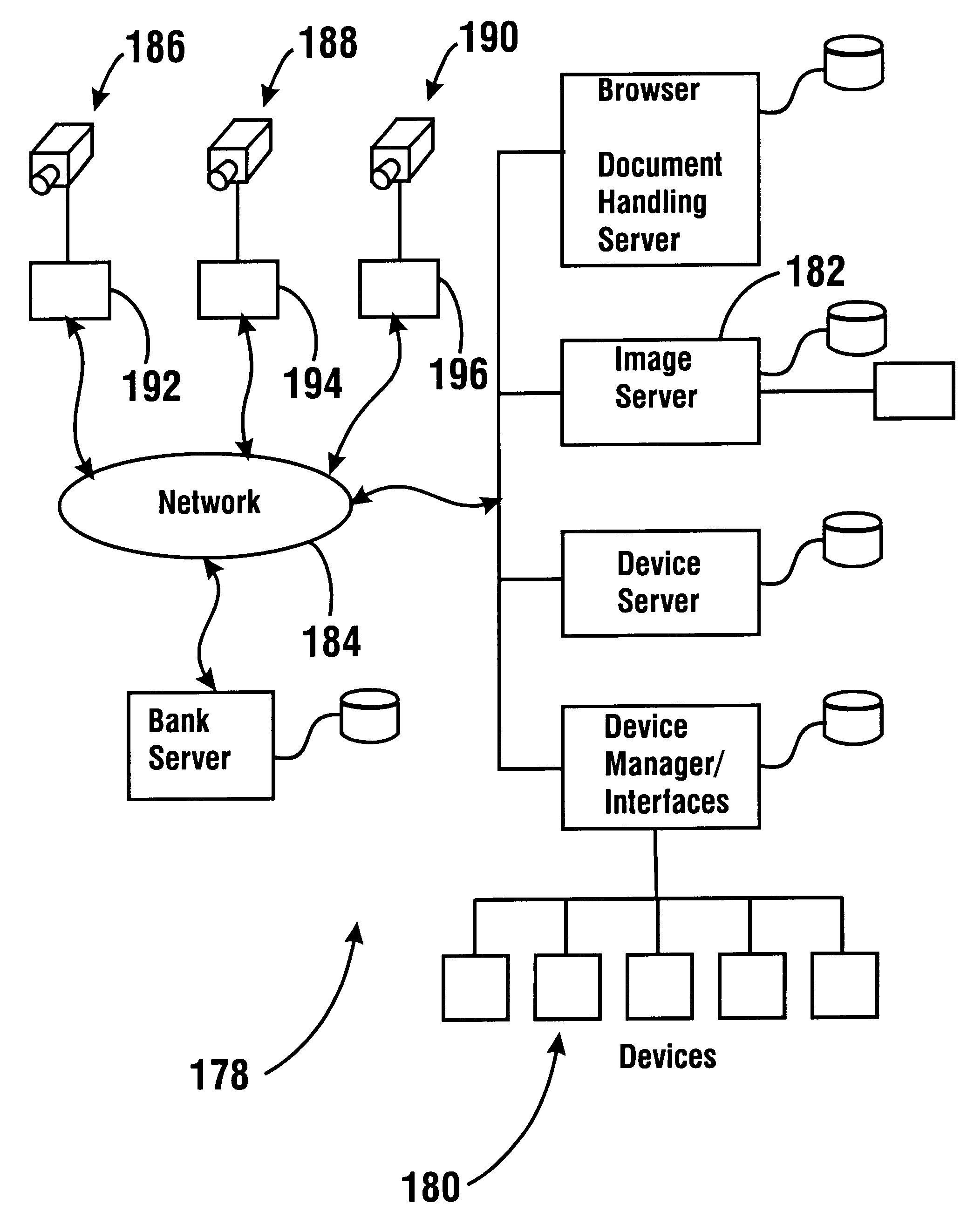

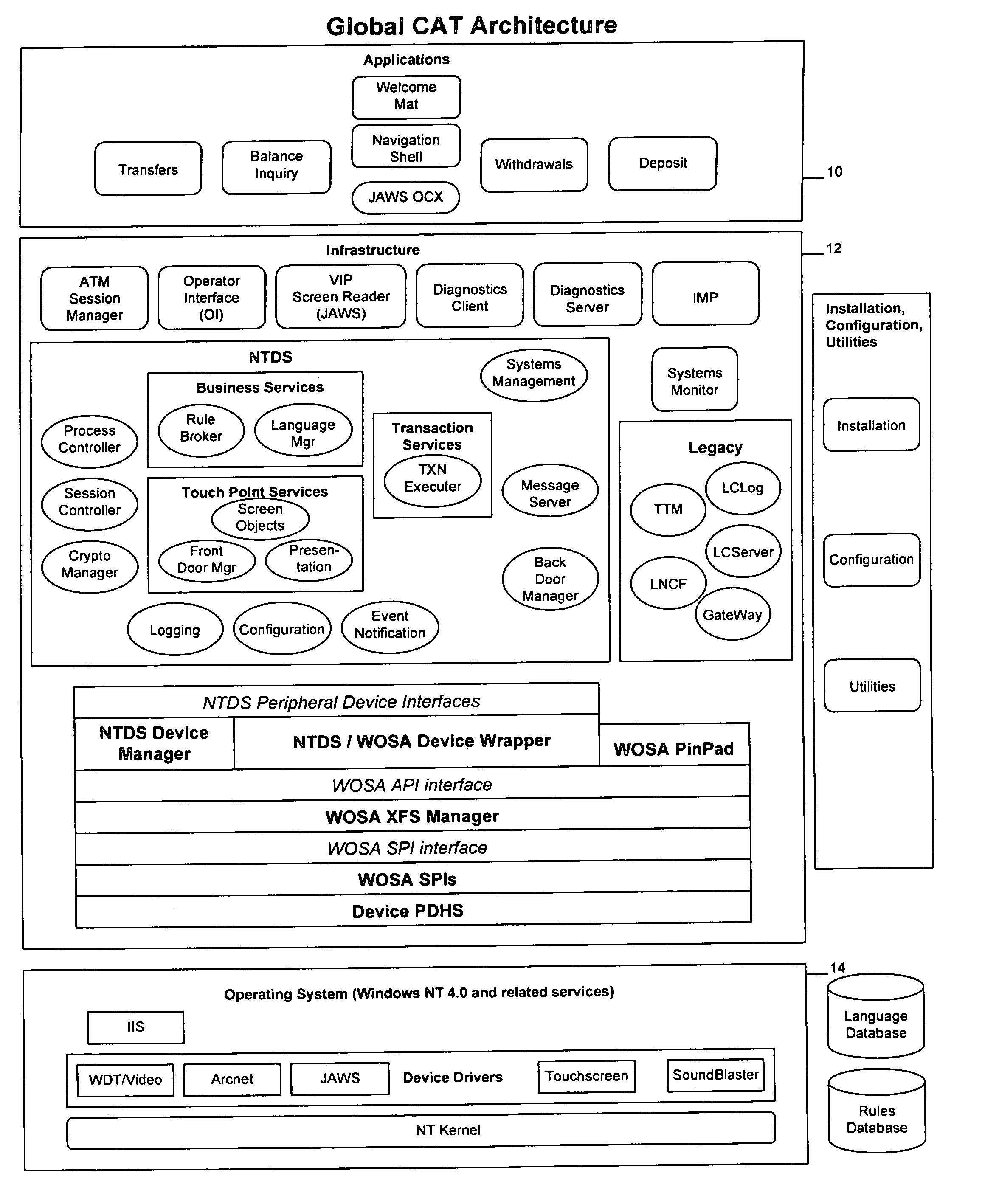

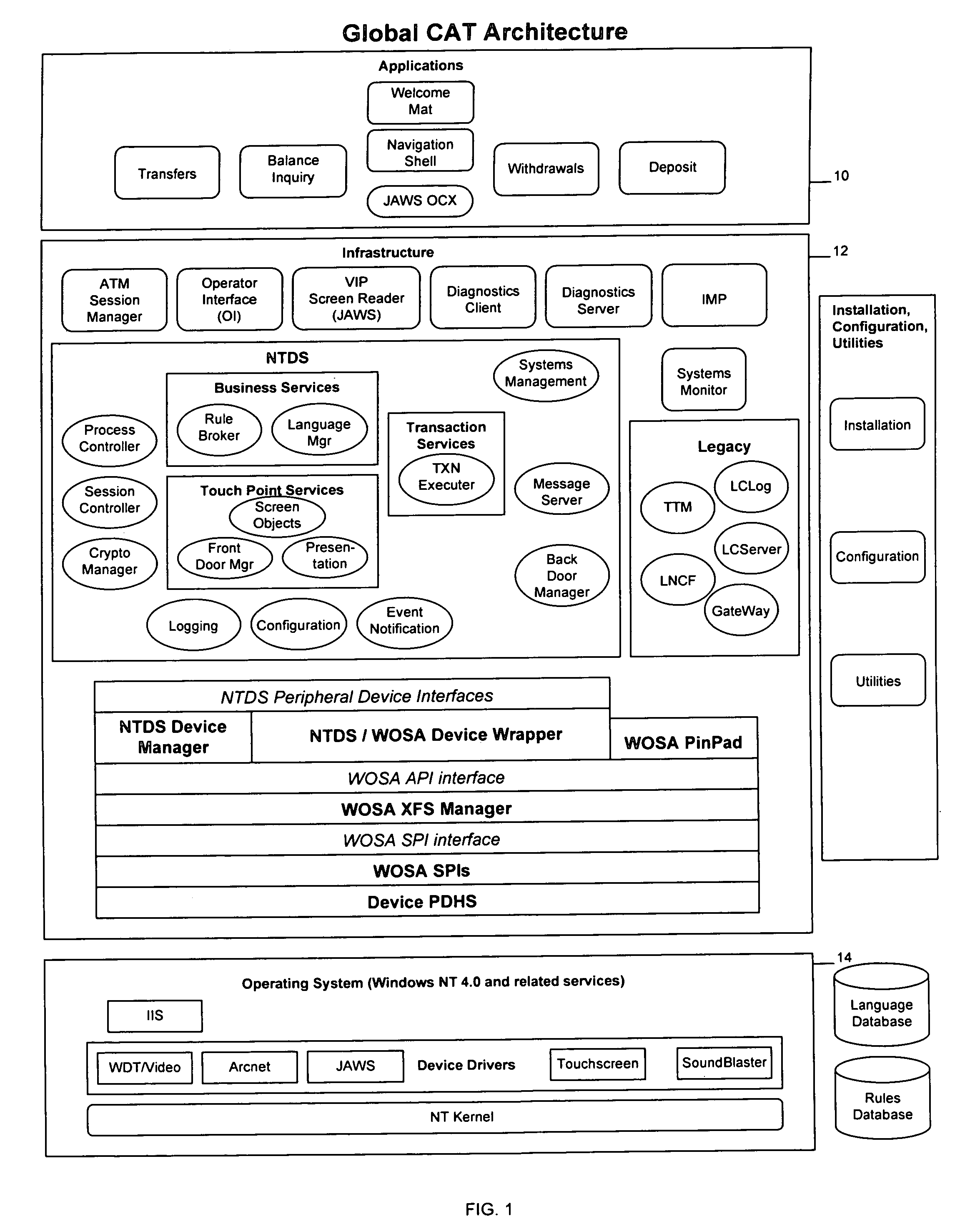

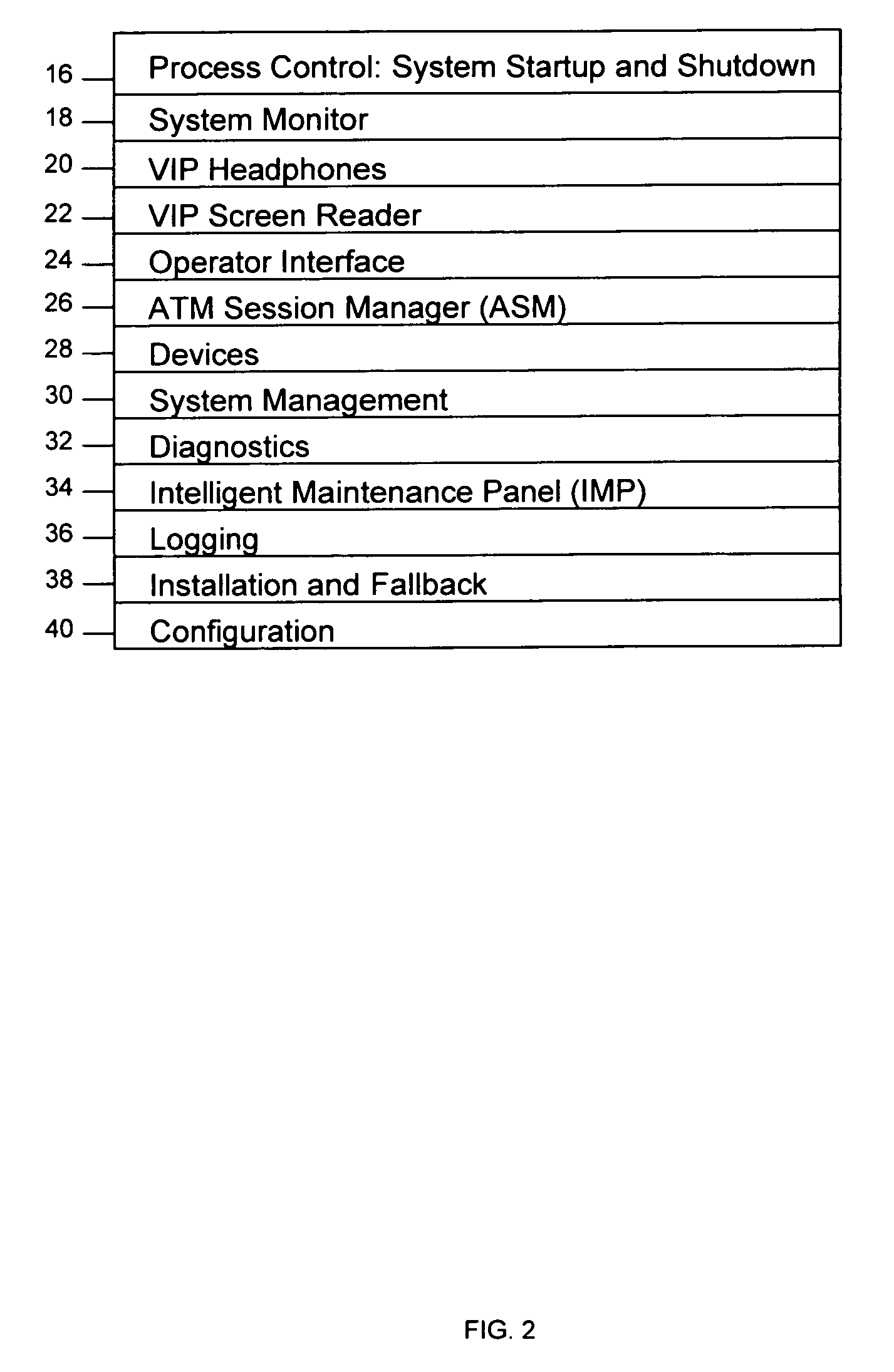

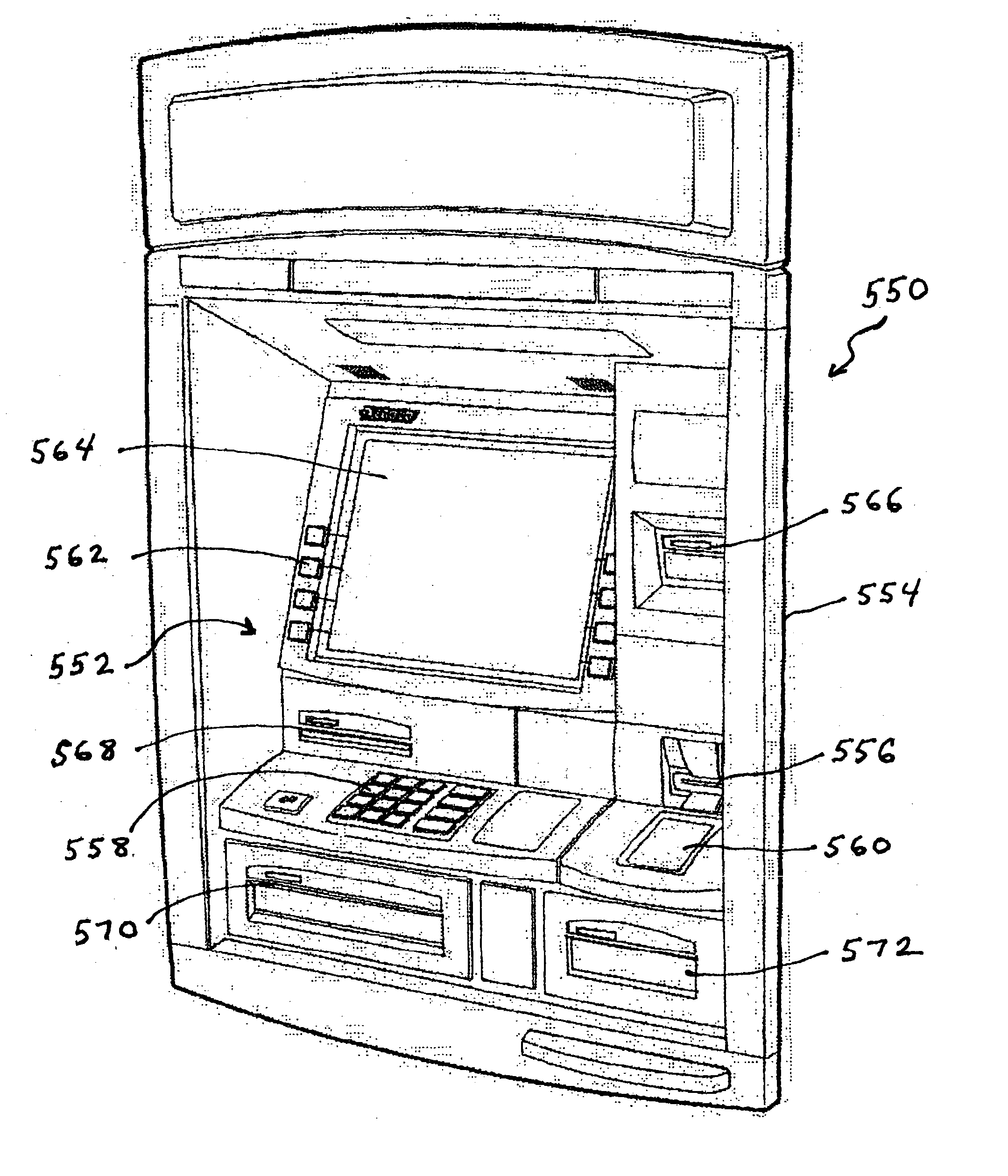

System and method for providing global self-service financial transaction terminals with worldwide web content, centralized management, and local and remote administration

A method and system for providing global self-service transaction terminals or automatic teller machines (ATMs) affords worldwide web content to ATM customers, centralized management for ATM operators, and supports local and remote administration for ATM field service personnel. The system includes multiple ATMs coupled over a network to a host, and the ATMs are provided with a touch screen interface and an interface for visually impaired persons. The ATMs enable both local and remote administration of ATM operations by bank personnel and an integrated network control. The ATMs are web-enabled, and ATM communications are performed over a communications network.

Owner:CITICORP CREDIT SERVICES INC (USA)

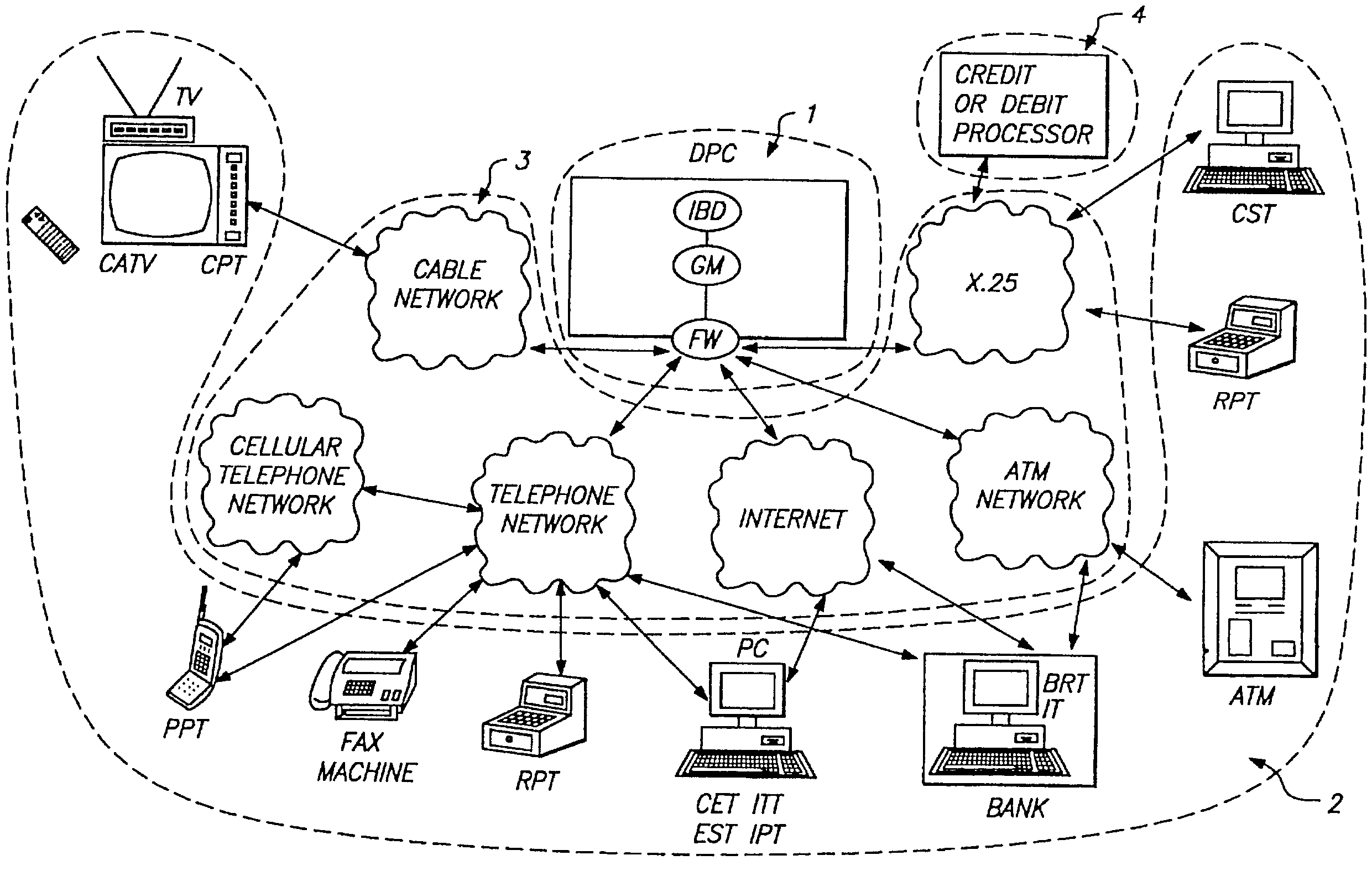

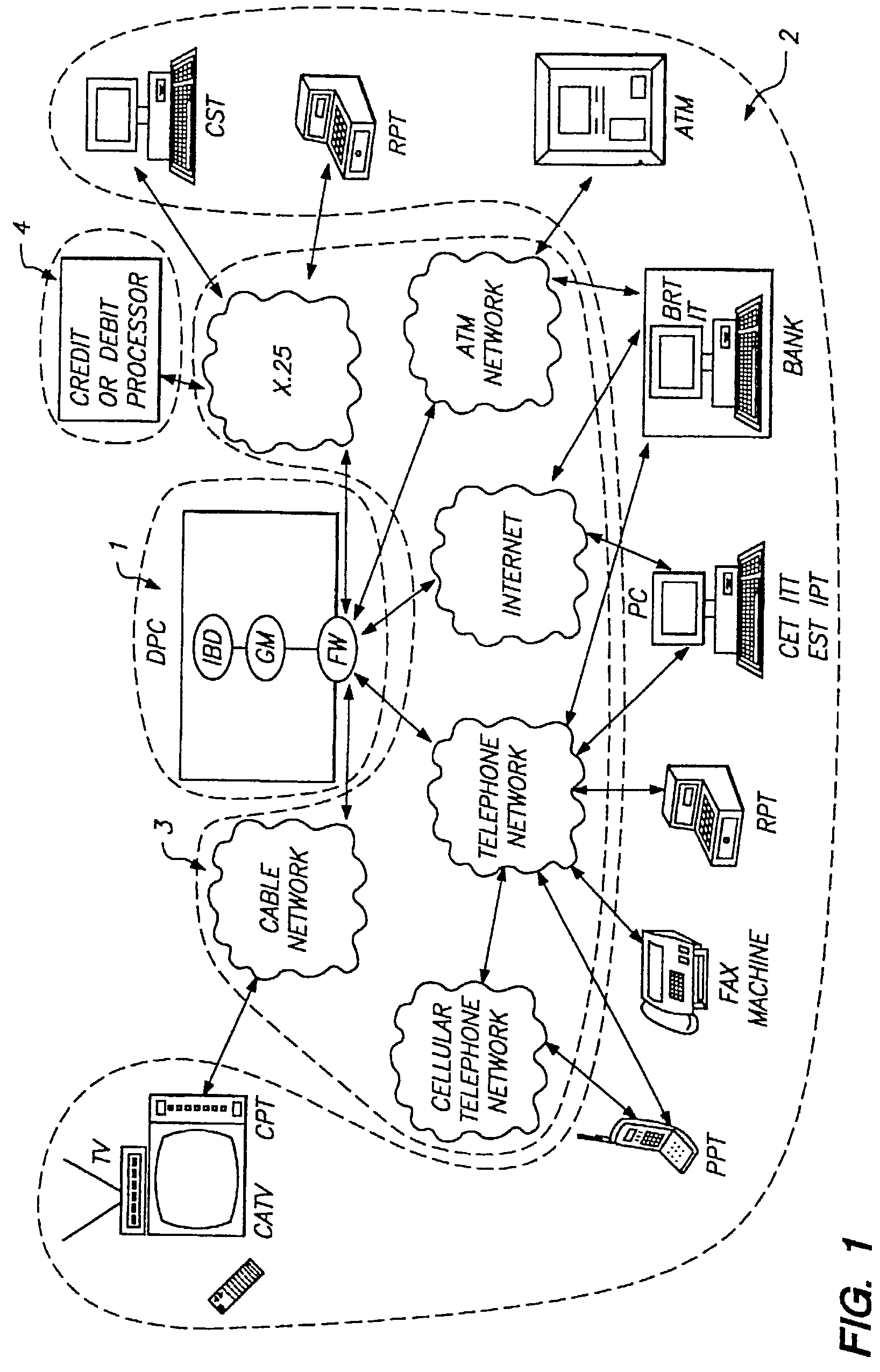

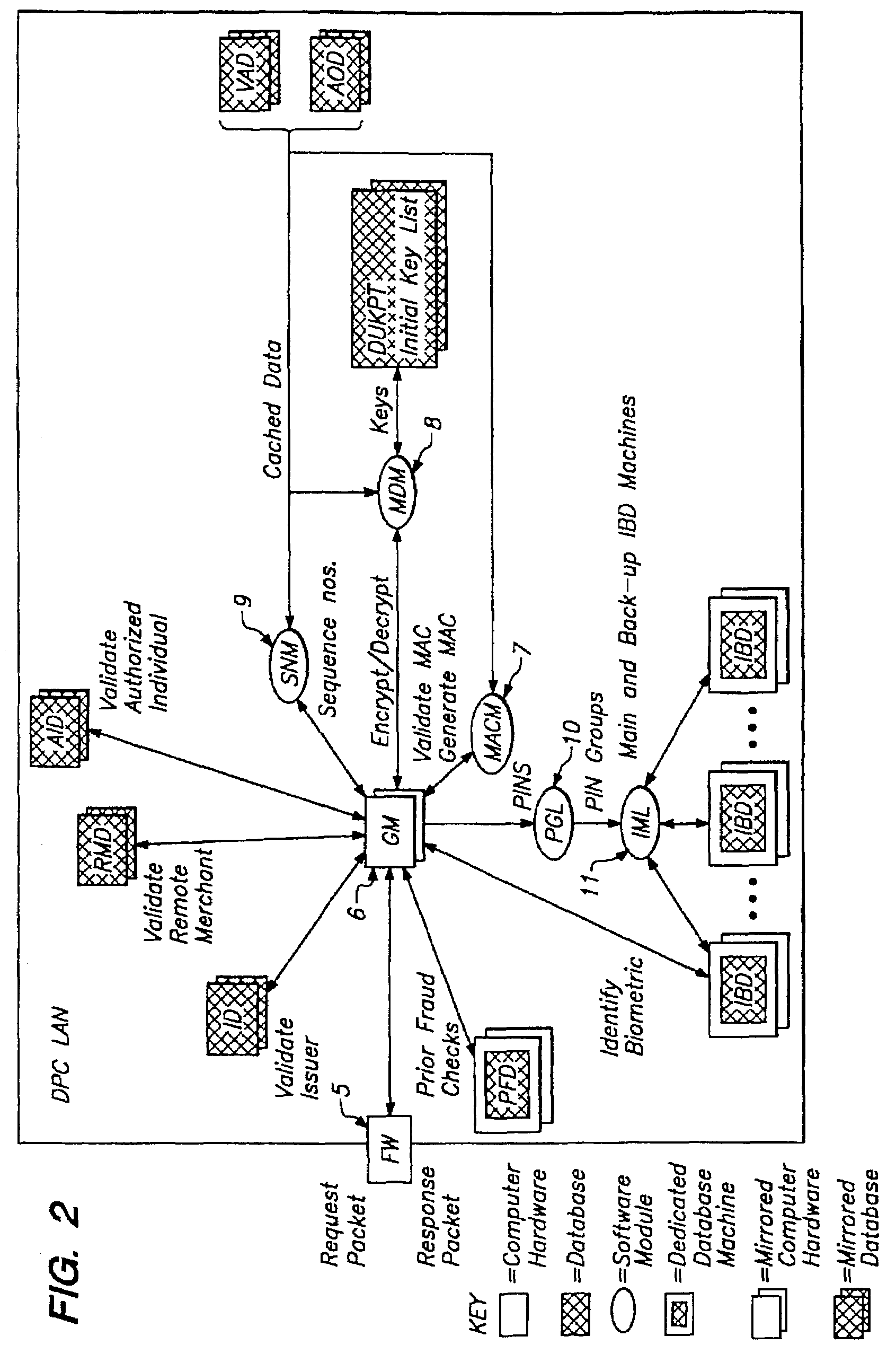

Tokenless identification system for authorization of electronic transactions and electronic transmissions

InactiveUS7152045B2Eliminate riskEnhances fraud resistanceCredit registering devices actuationDigital data processing detailsElectronic transmissionComputerized system

A tokenless identification system and method for authorization of transactions and transmissions. The tokenless system and method are principally based on a correlative comparison of a unique biometrics sample, such as a finger print or voice recording, gathered directly from the person of an unknown user, with an authenticated biometrics sample of the same type obtained and stored previously. It can be networked to act as a full or partial intermediary between other independent computer systems, or may be the sole computer systems carrying out all necessary executions. It further contemplates the use of a private code that is returned to the user after the identification has been complete, authenticating and indicating to the user that the computer system was accessed. The identification system and method of additionally include emergency notification to permit an authorized user to alert authorities an access attempt is coerced.

Owner:EXCEL INNOVATIONS +1

Automated banking apparatus and method

InactiveUS20040016796A1Accurate specificationsGood user interfaceComplete banking machinesCoin/currency accepting devicesFinancial transactionCheque

An automated banking apparatus is operative to carry out banking transactions commonly required by merchants. The apparatus includes an item accepting depository for accepting deposit items, such as deposit bags, currency, and checks. The apparatus further includes an input device that is operative to interrogate an RFID tag to obtain merchant deposit information therefrom. The information can include data representative of the deposit, such as an account number and the deposit amount. The RFID tag may be located on an item being deposited.

Owner:DIEBOLD NIXDORF

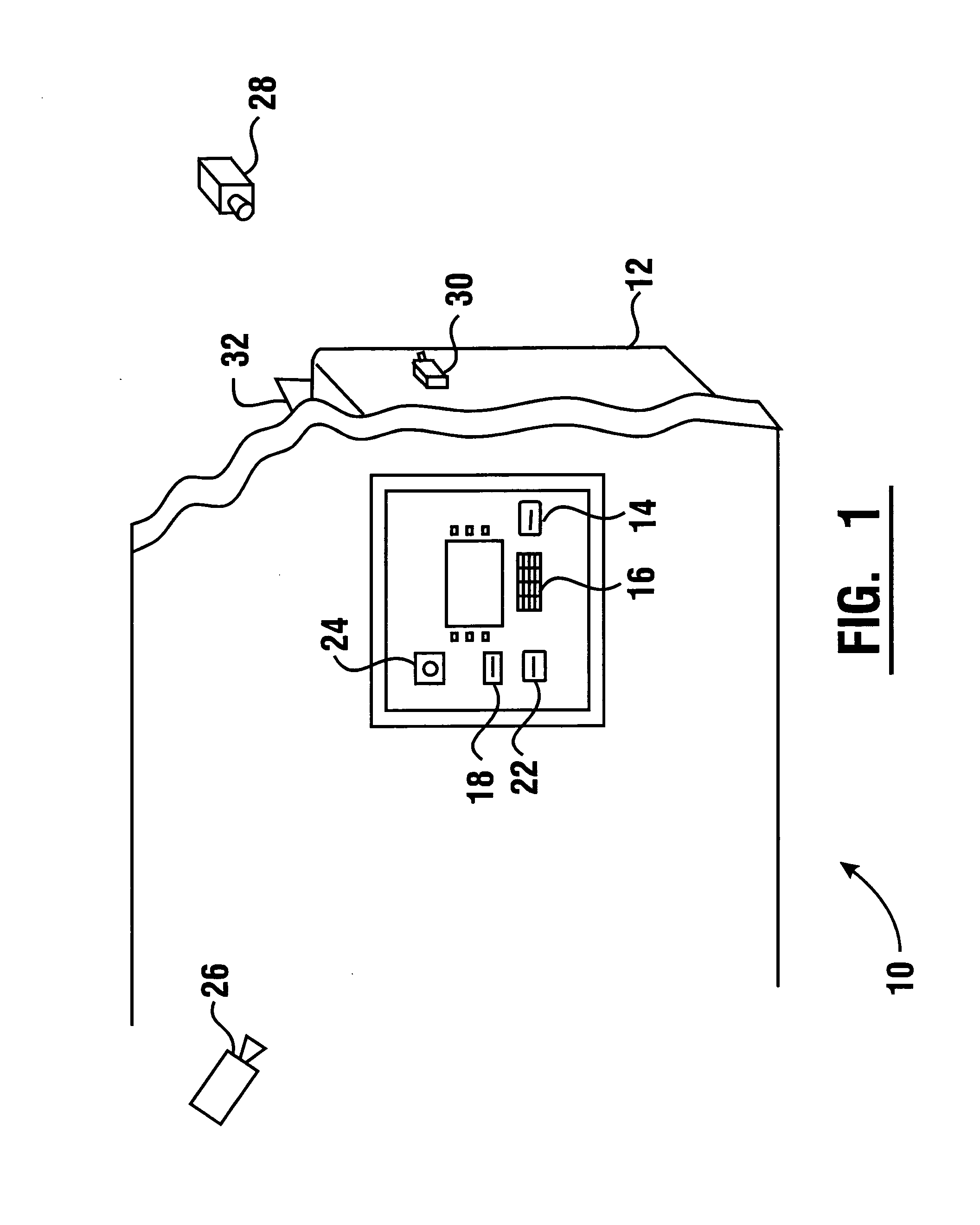

System and method for capturing and searching image data associated with transactions

InactiveUS7595816B1Increase valueGreat assuranceComplete banking machinesColor television detailsPattern recognitionData pack

A system and method for capturing image data captures images responsive to programmed sequences. The sequences are performed on a periodic basis as well as in response to inputs corresponding to alarm conditions and transactions conducted at automated banking machines or other devices. Image data may also be captured in response to image conditions including the sensing of motion or the loss of usable video from selected cameras. Image data is stored in connection with data corresponding to circumstances associated with each triggering event. Stored image data may be searched by one or more parameters. Parameters include data stored in association with each image, types of events causing image data to be stored, as well as other image conditions in stored images.

Owner:DIEBOLD NIXDORF

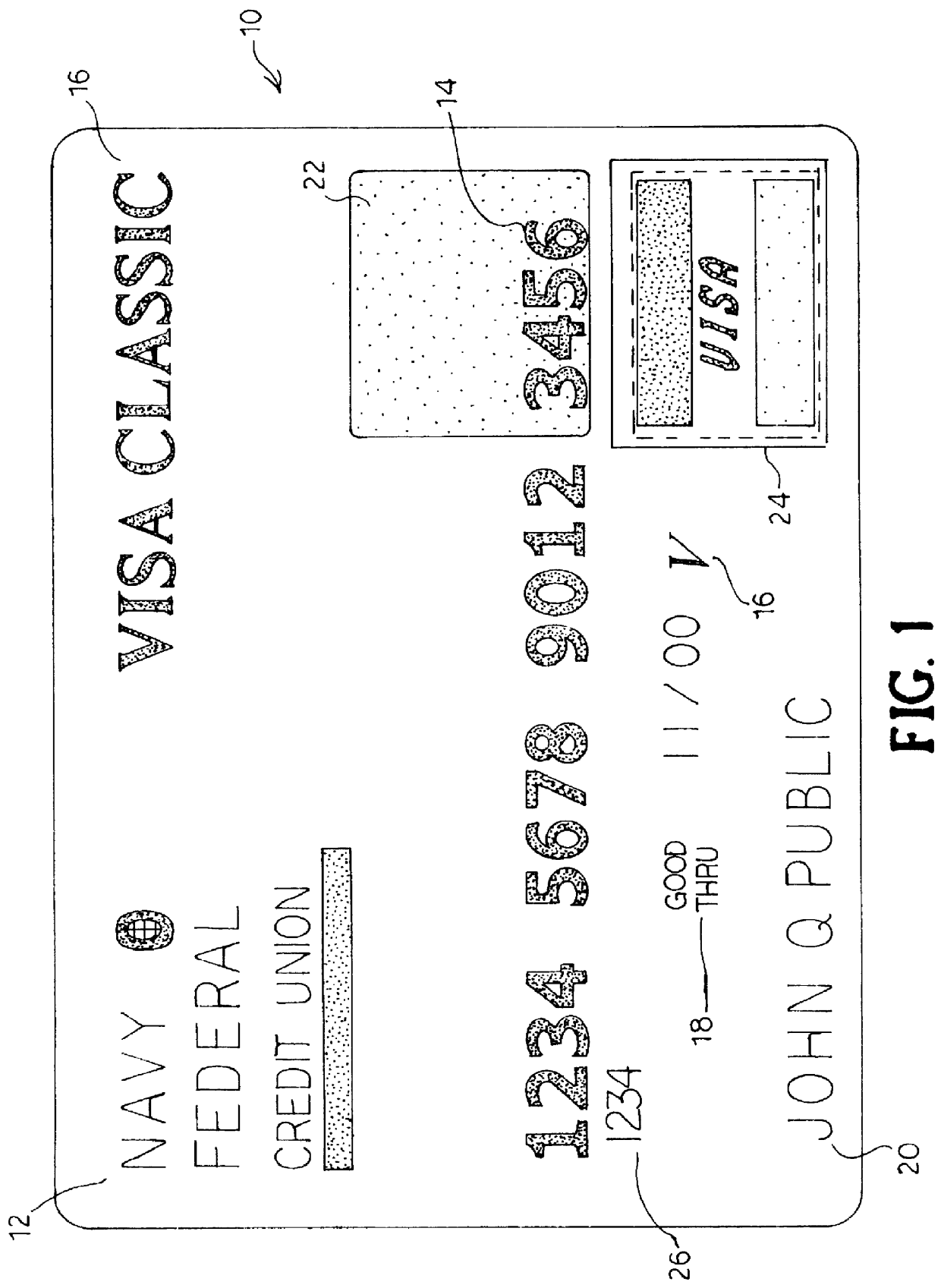

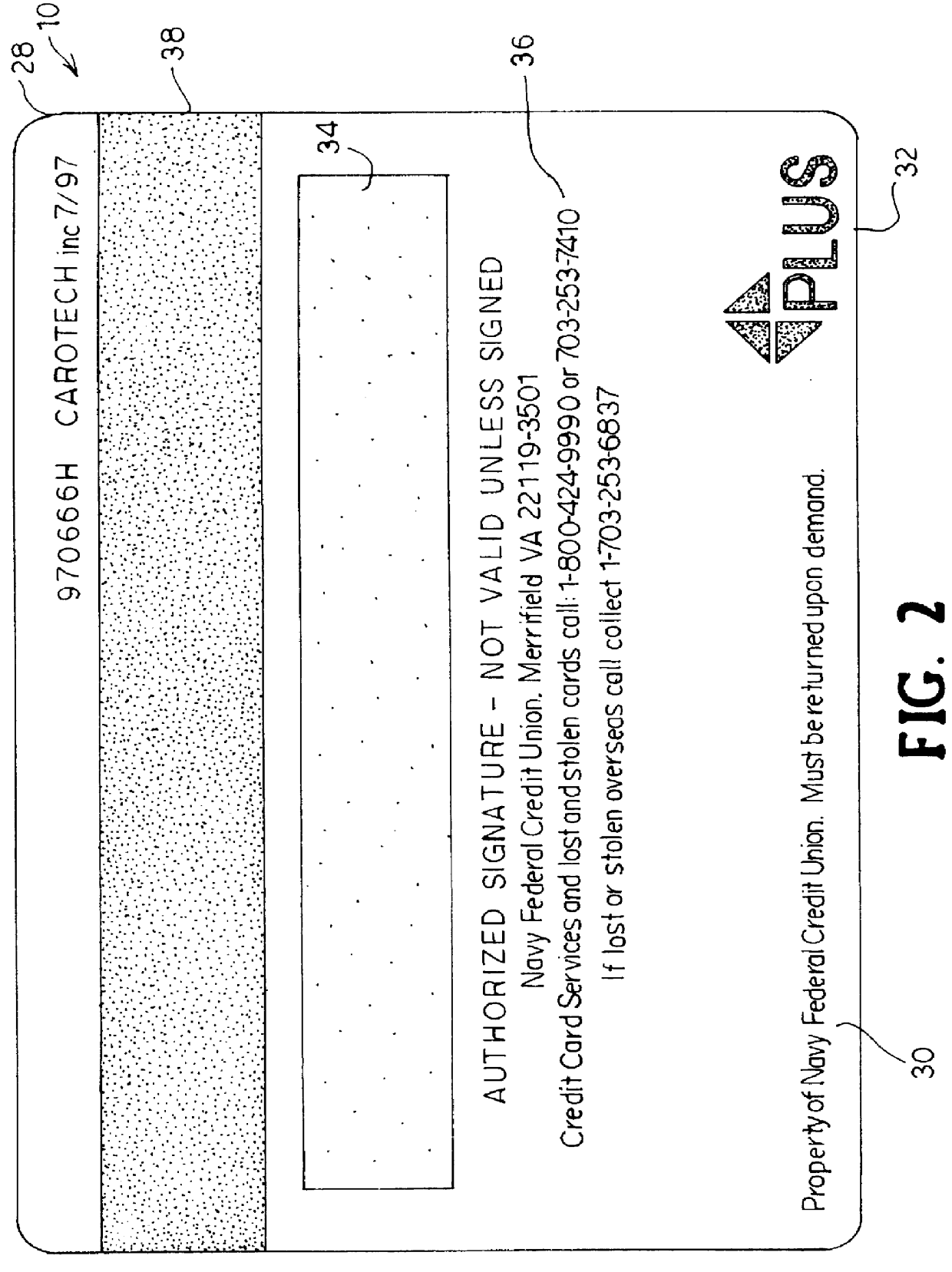

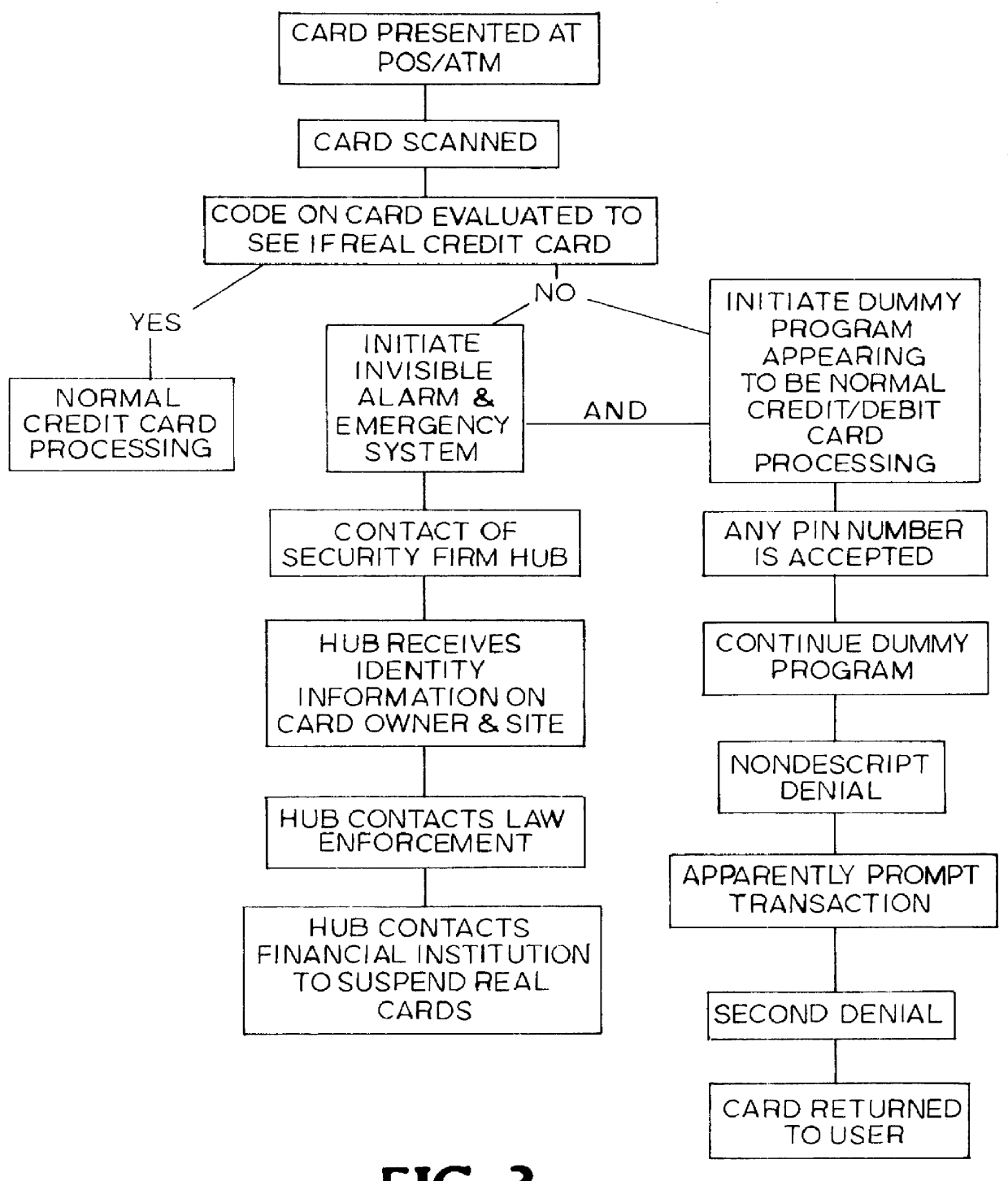

Security card and system for use thereof

InactiveUS6068184AIncreased peace of mindLower success rateComplete banking machinesFinanceCredit cardEmergency situations

A security card system that includes a security card having an appearance like a real credit card or other bank card, and a security network that contains a security firm that enrolls persons in the system who have been provided with a security card by a card-issuing institution, and uses the security network for responding to emergency calls initiated by use of the security card, reports fraud, and in general, implements an emergency system and acts as a theft deterrent.

Owner:BARNETT DONALD A

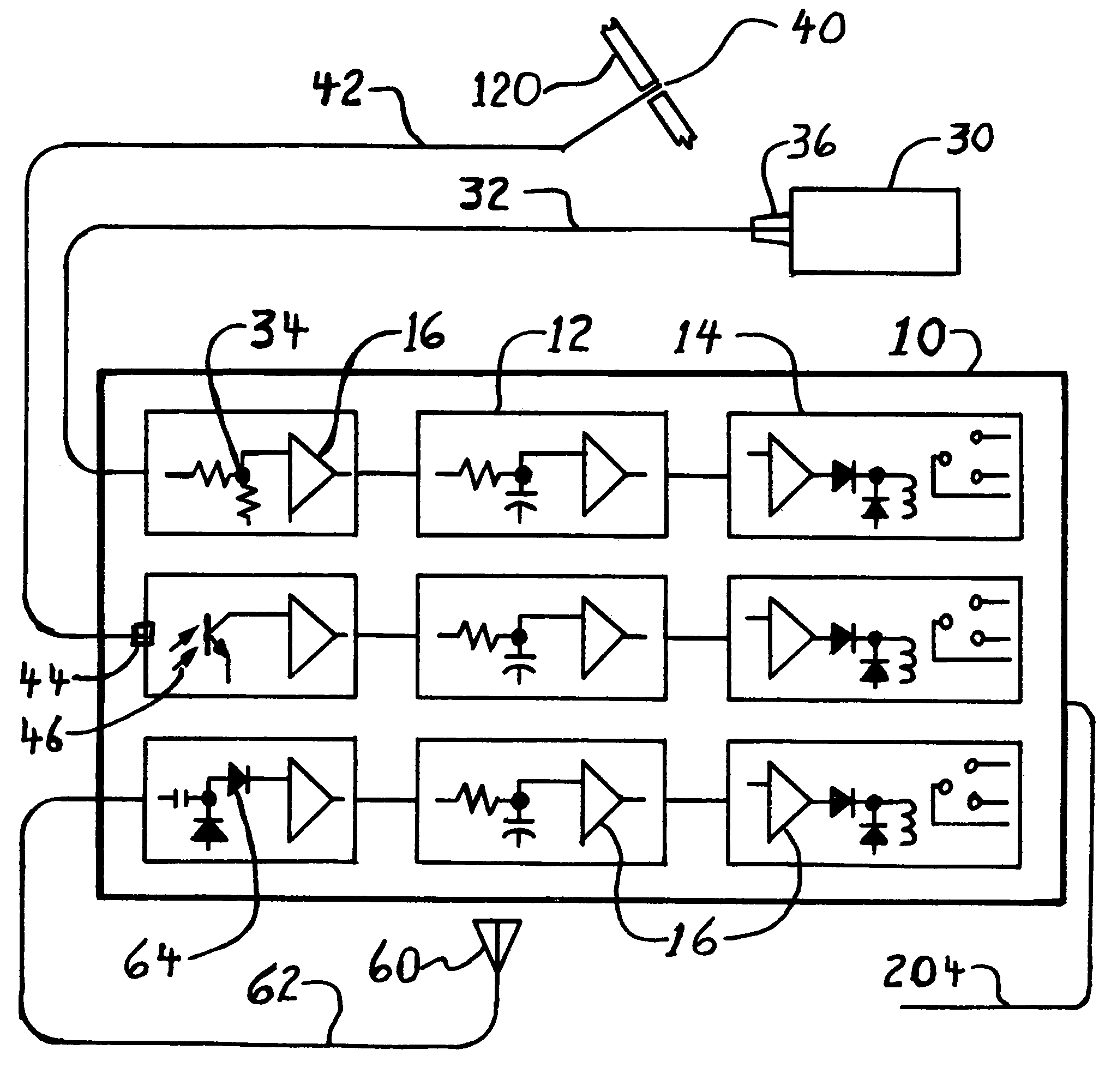

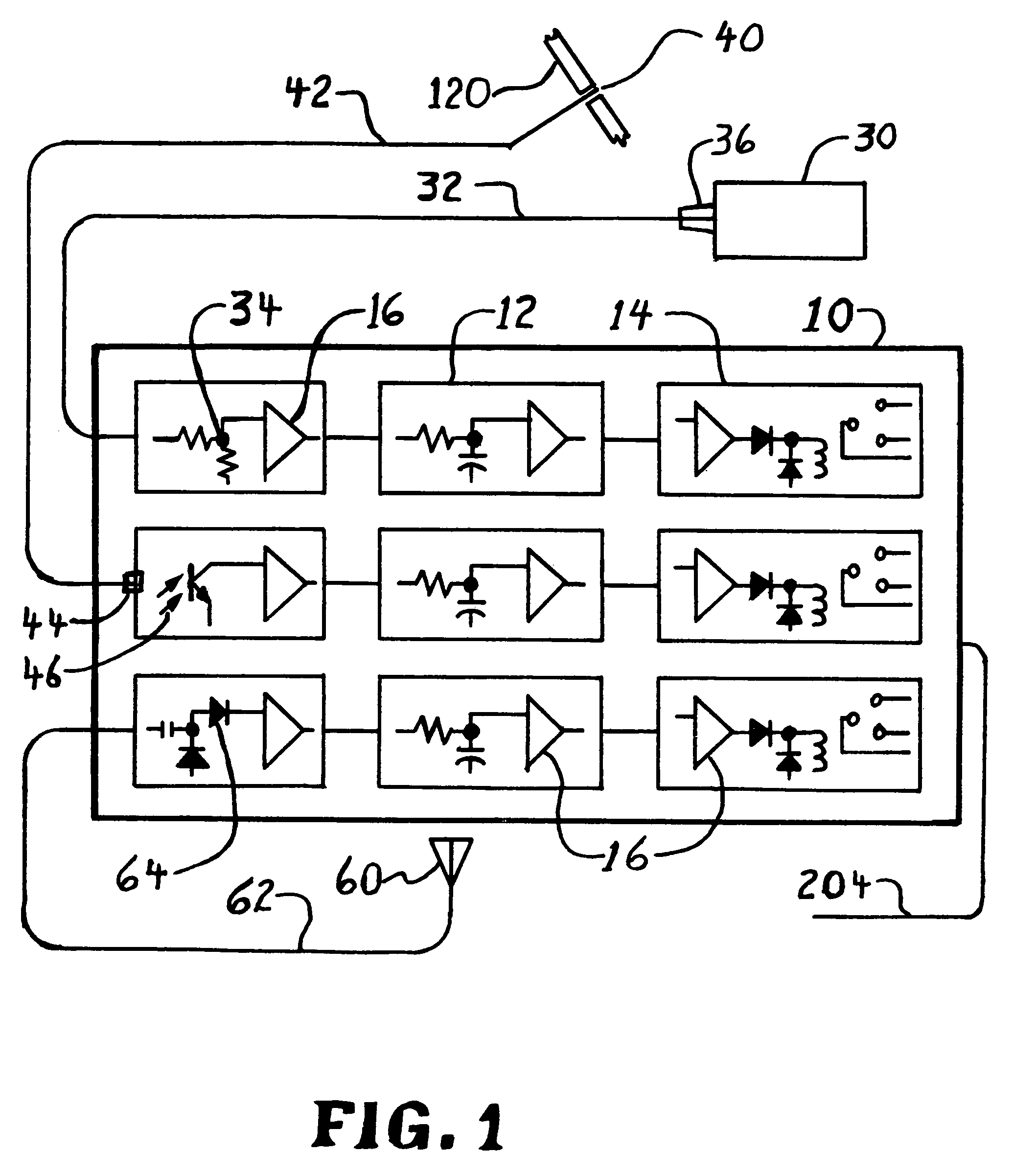

Alarm with remote monitor and delay timer

InactiveUS7075429B2Easy to installEasy maintenanceBurglar alarm by openingATM surveillanceFiberEngineering

An alarm apparatus for detecting an intrusion or compromise situation upon critical equipment or private areas. The apparatus detects an unauthorized radio transmitter (like a wireless camera), or the covering of a critical piece of equipment. Fiber optics, solar cells and special radio antennas are used to detect intrusion remotely and a delay timer will allow normal activity to occur, while reducing false alarms. This alarm apparatus will notify an existing system of the intrusion or compromise when limits are exceeded. This alarm apparatus also addresses privacy concerns of wireless cameras and recording devices in areas like changing rooms, bathrooms, or boardrooms. The apparatus addresses security issues for critical devices like smoke alarms and ATM machines.

Owner:MARSHALL CRANBROOK

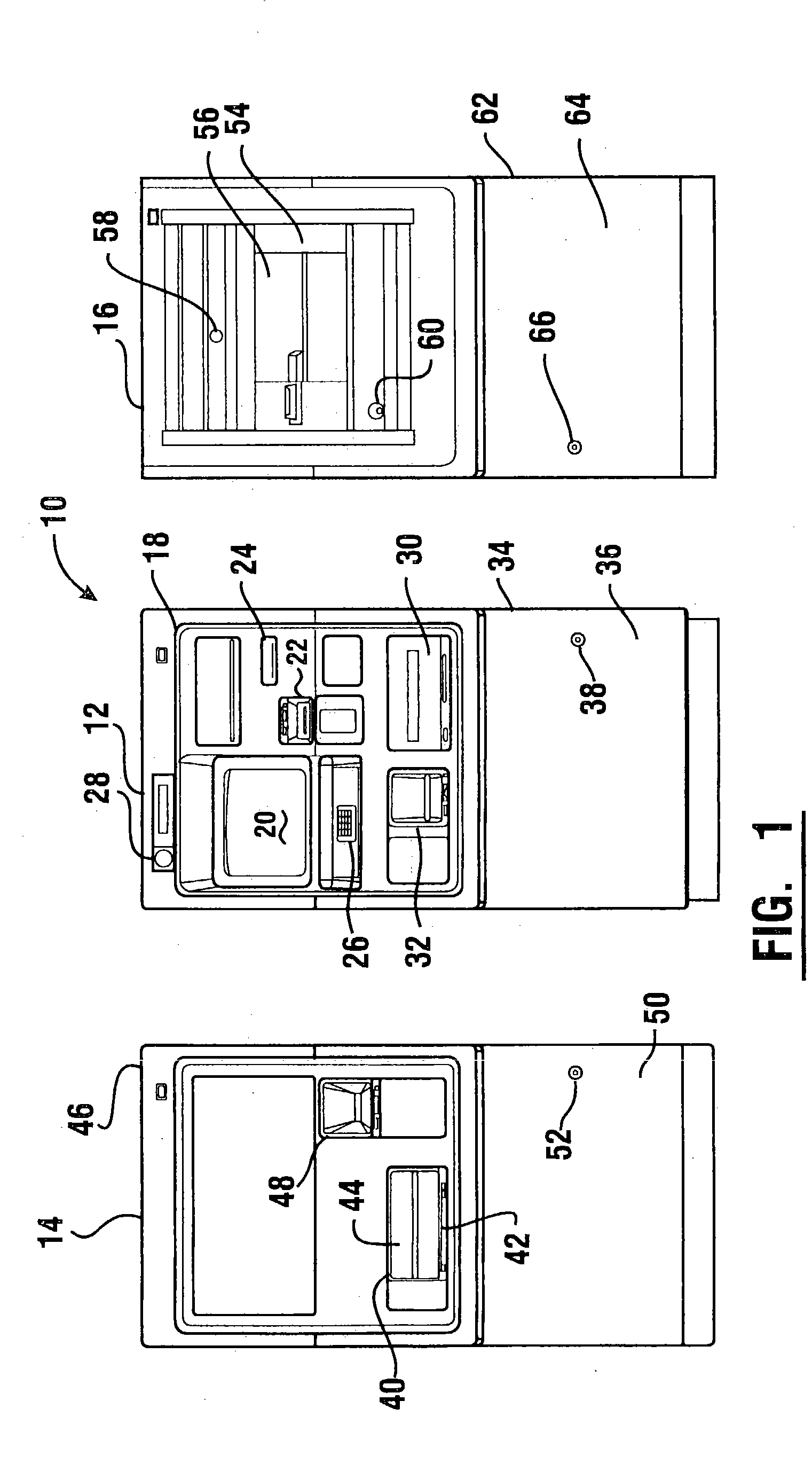

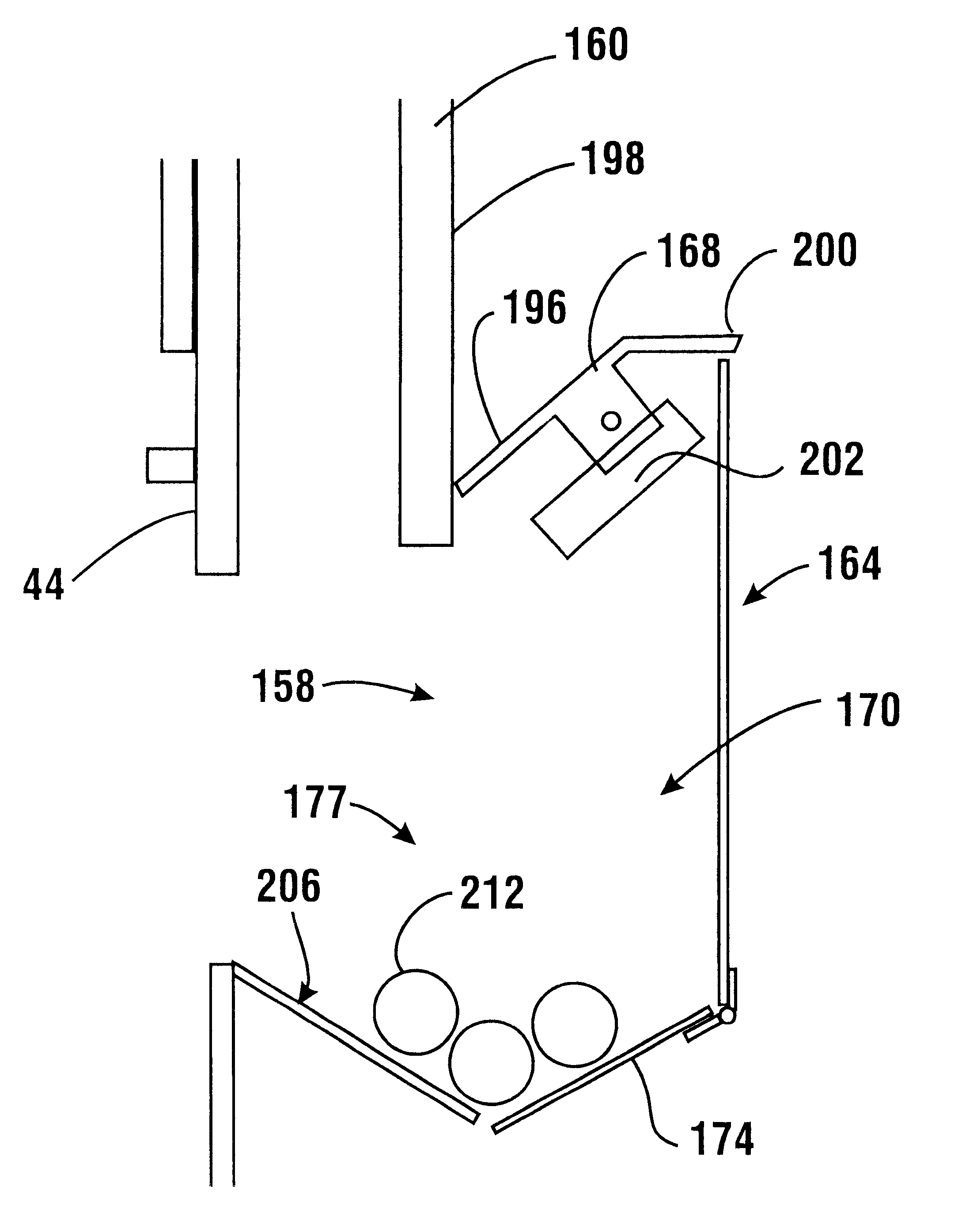

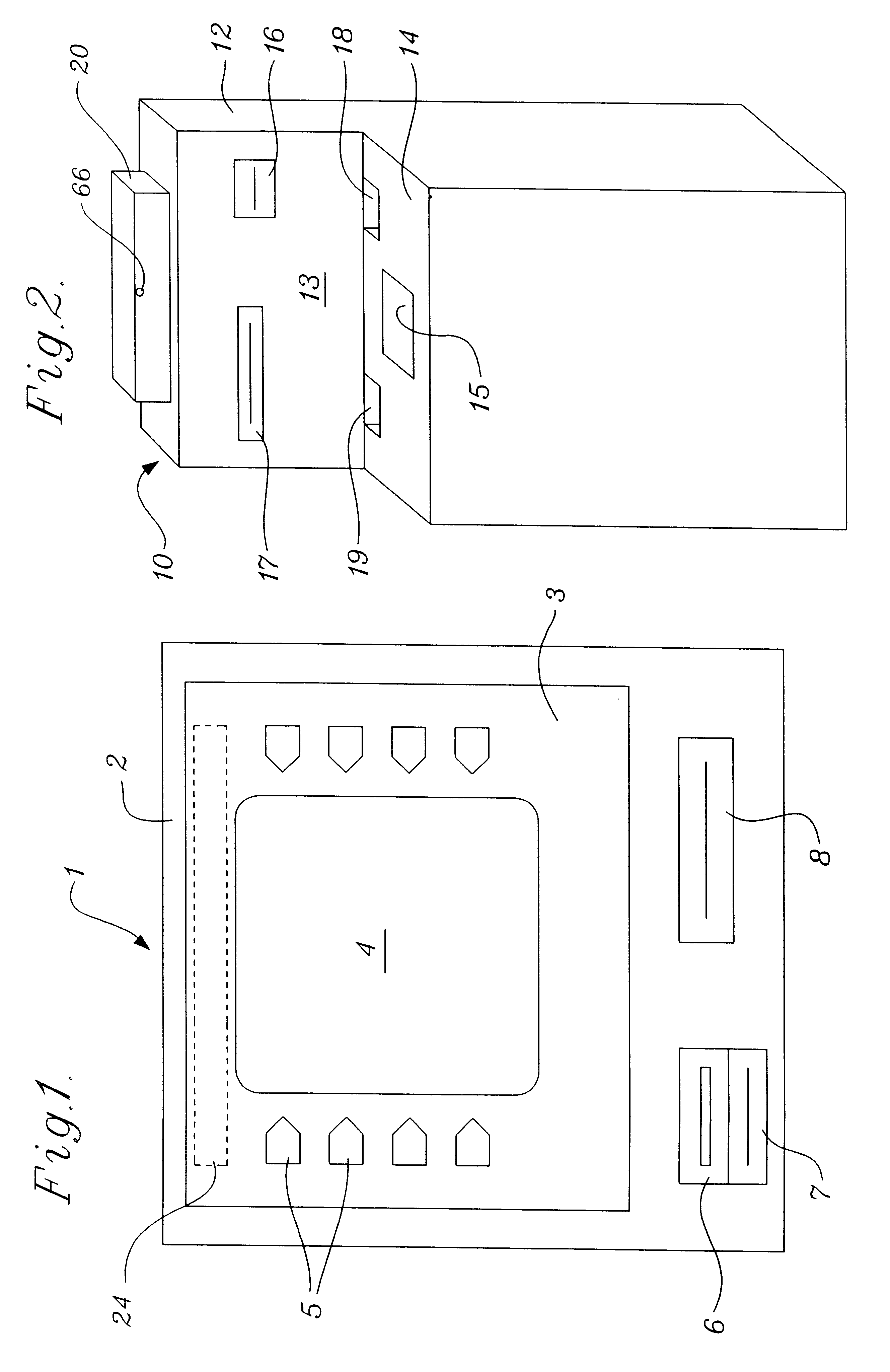

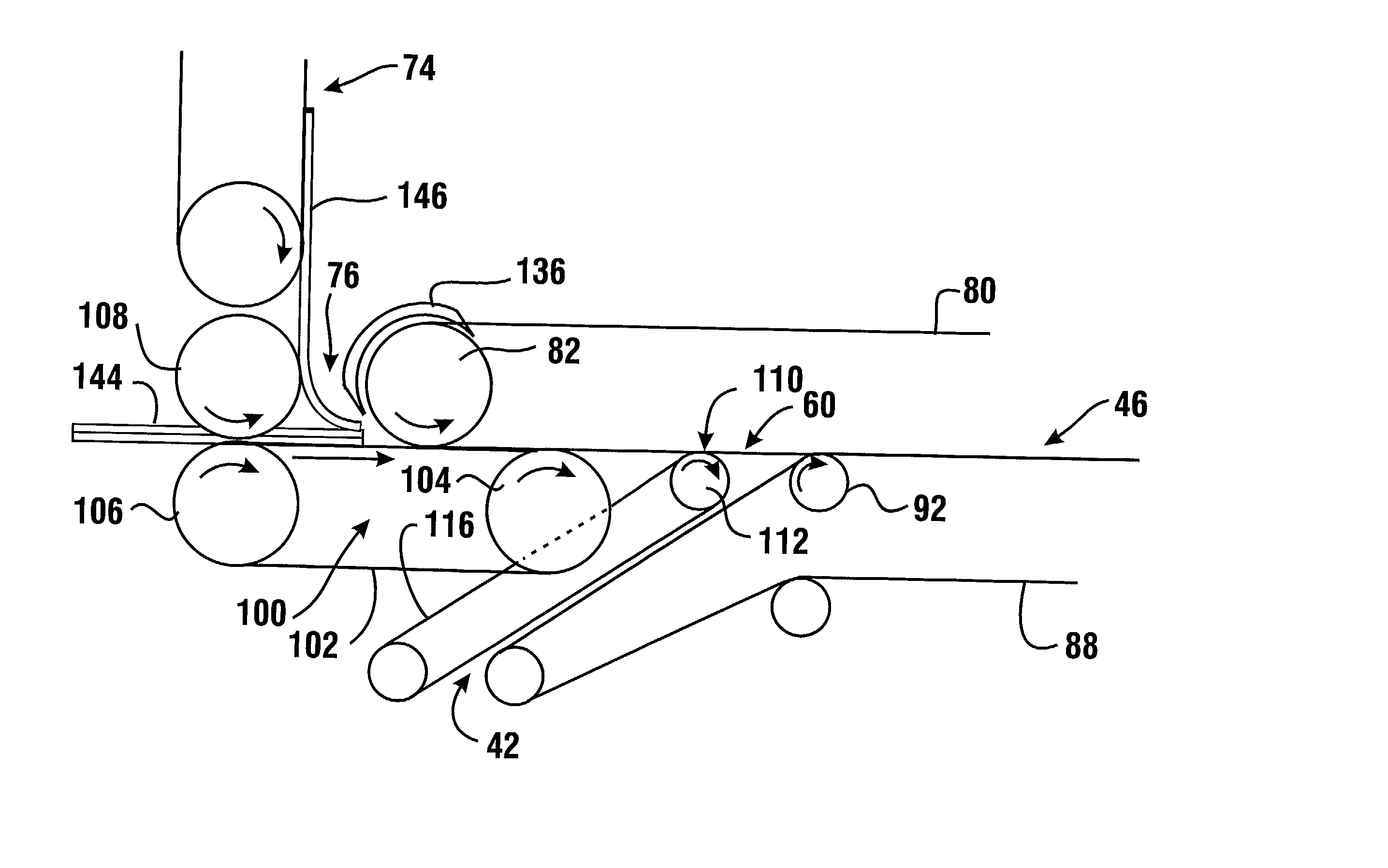

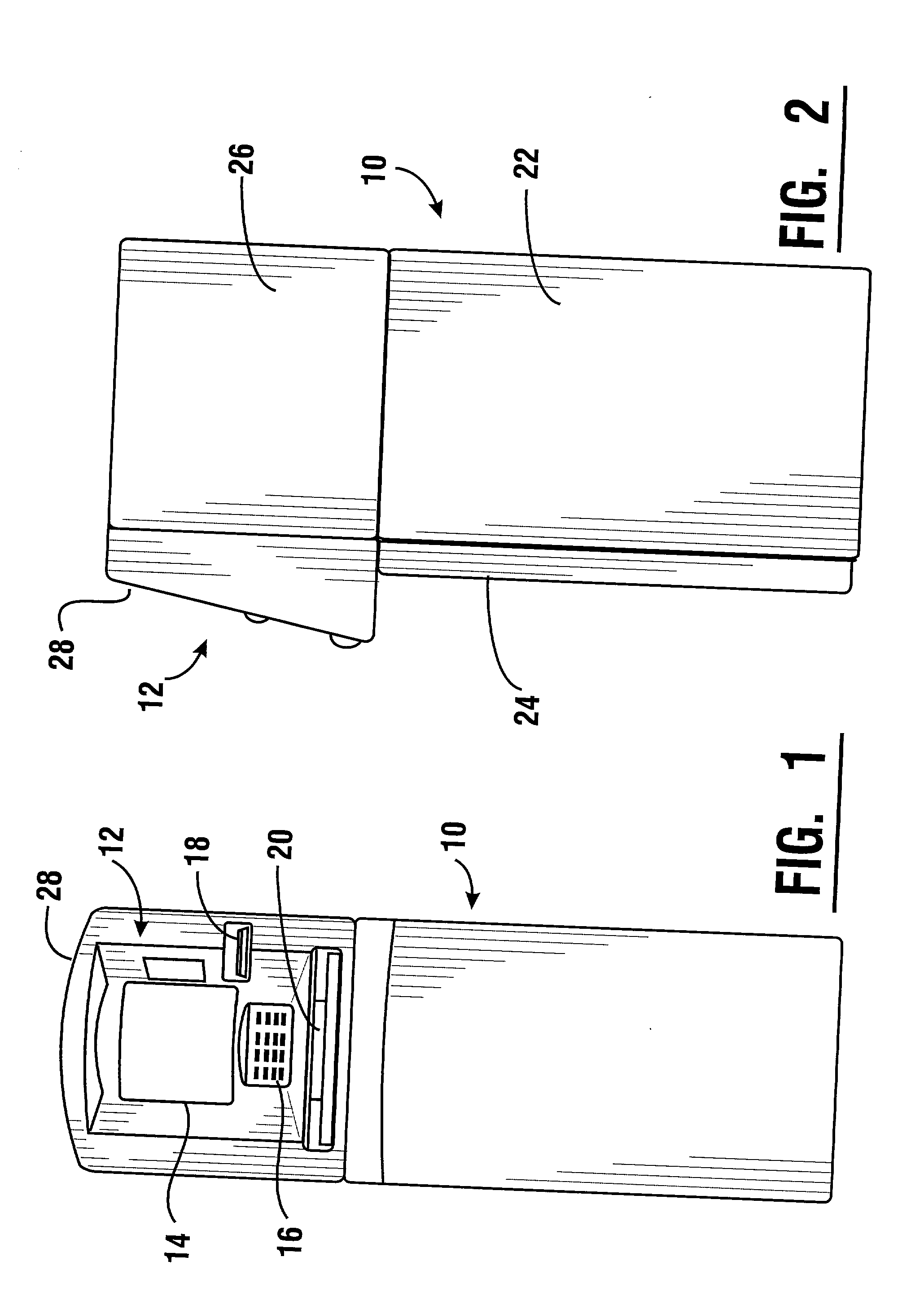

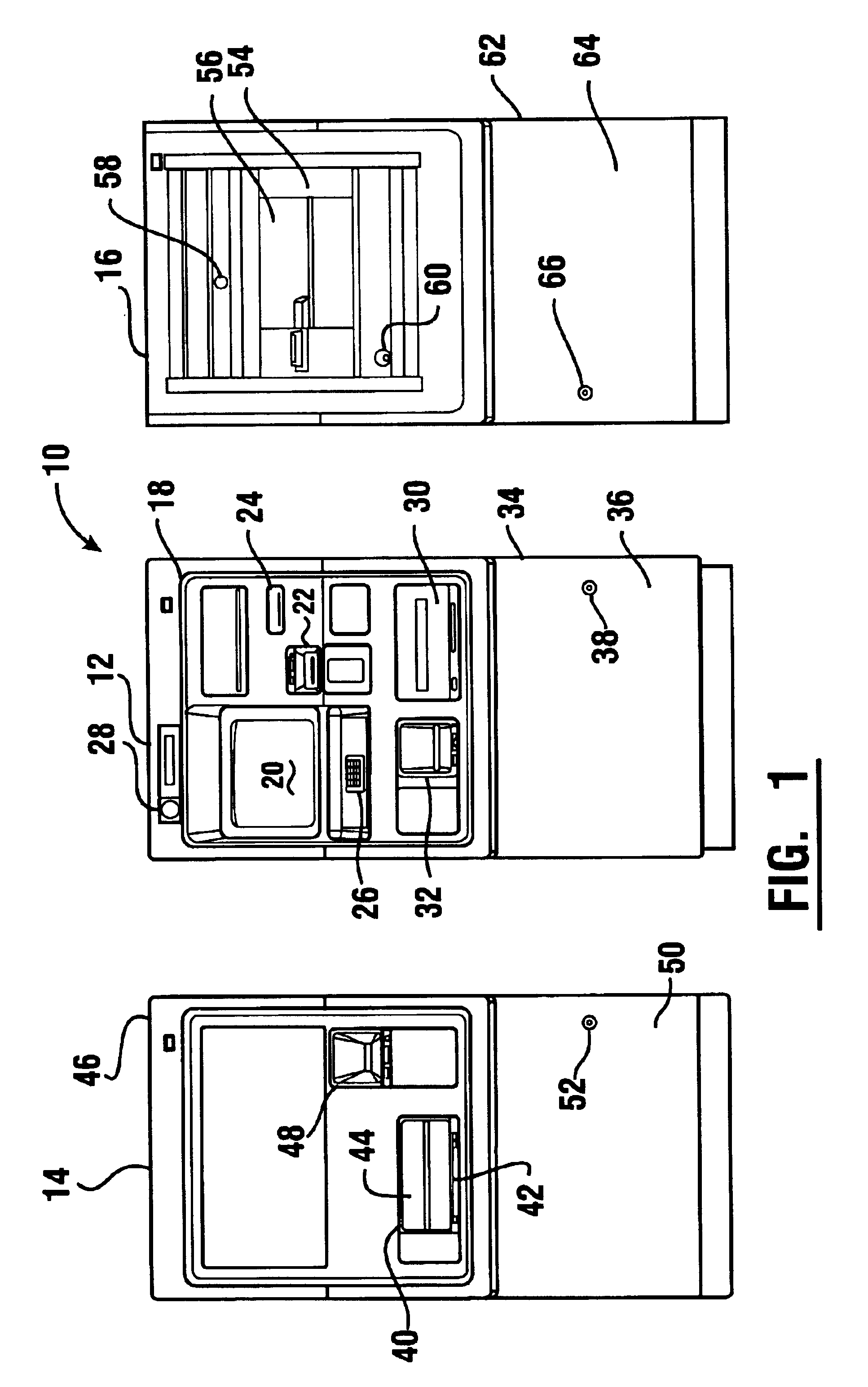

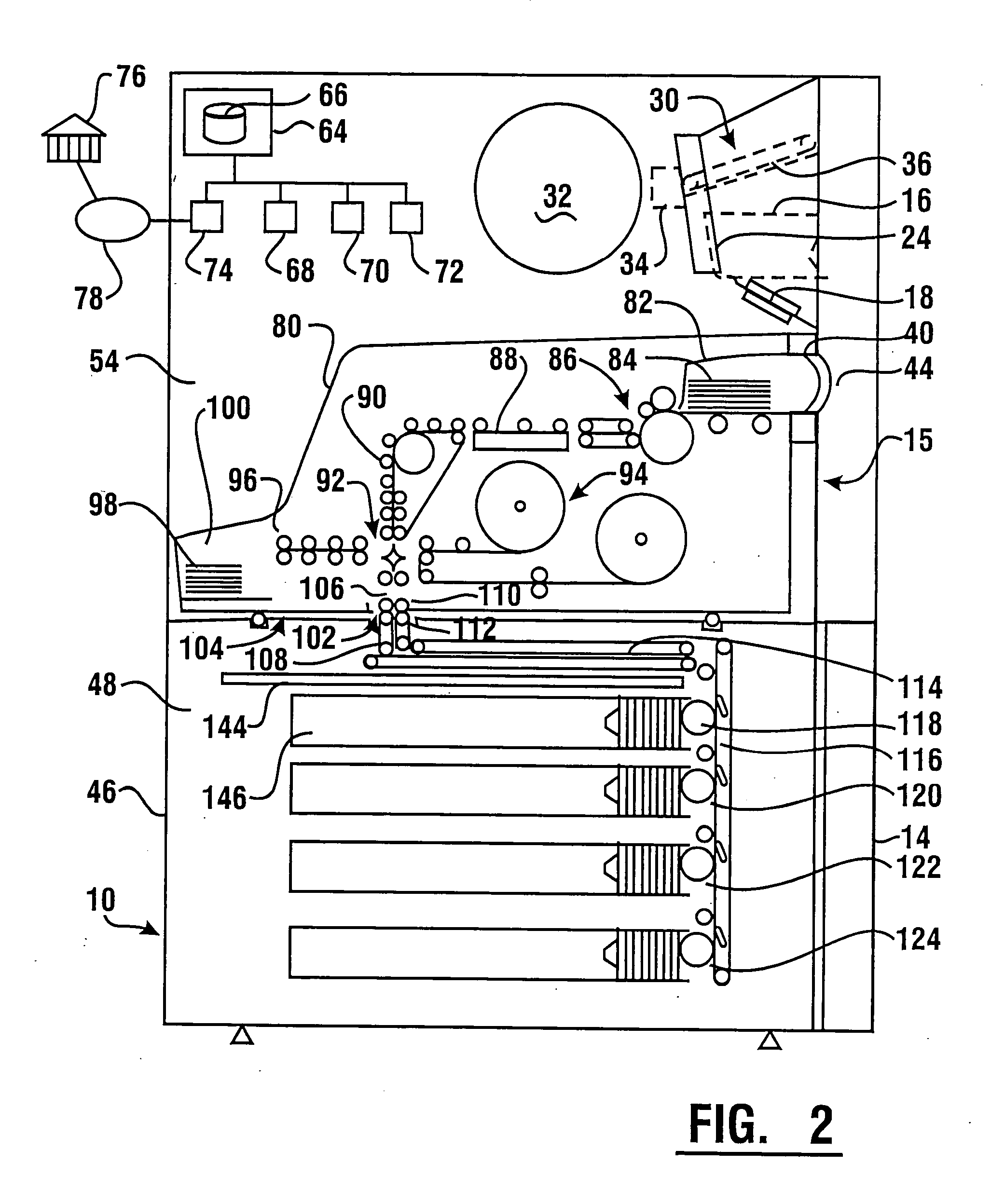

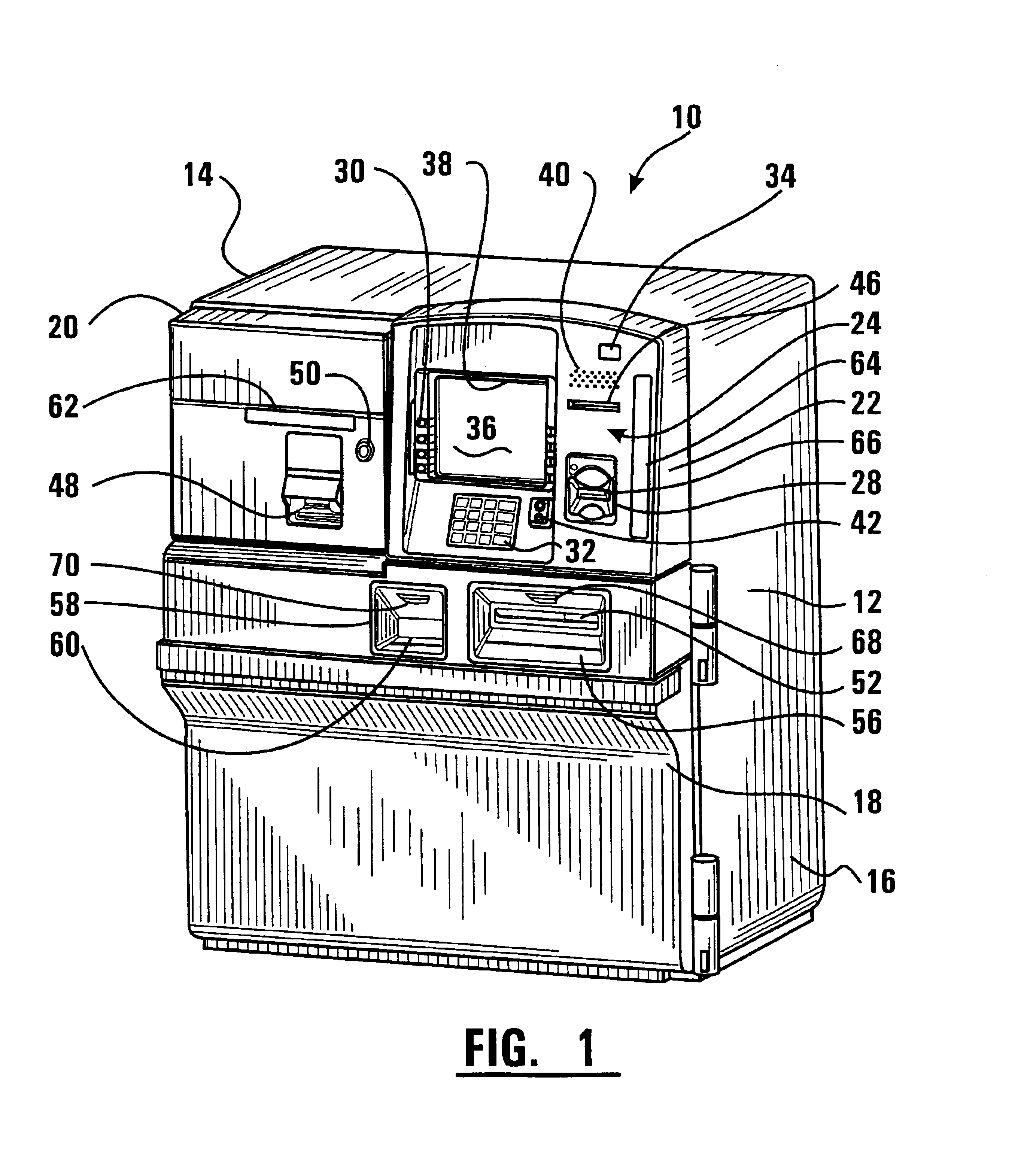

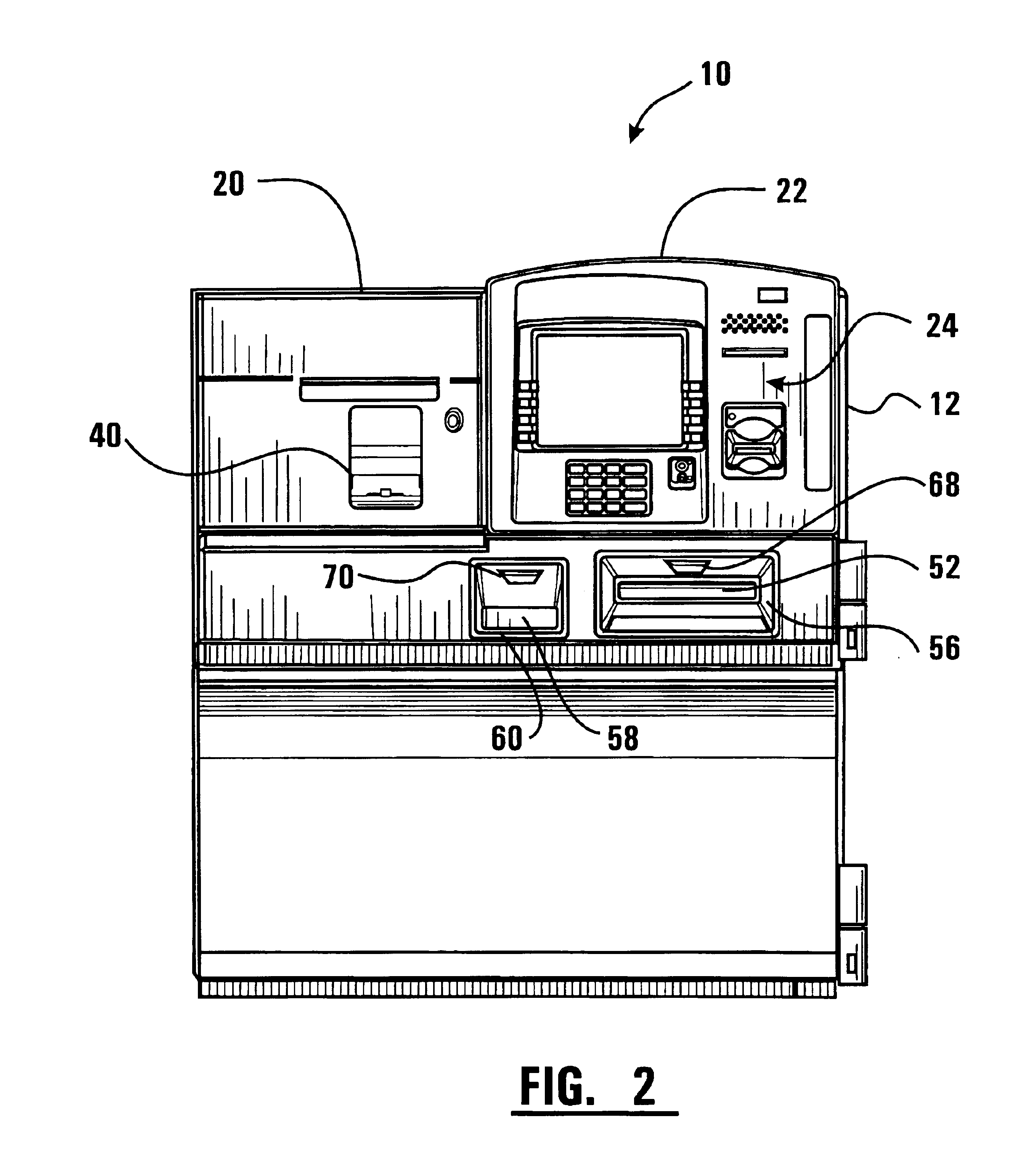

Automated merchant banking apparatus and method

InactiveUS6230928B1Good user interfaceAccurate specificationsComplete banking machinesRacksOutput deviceBiomedical engineering

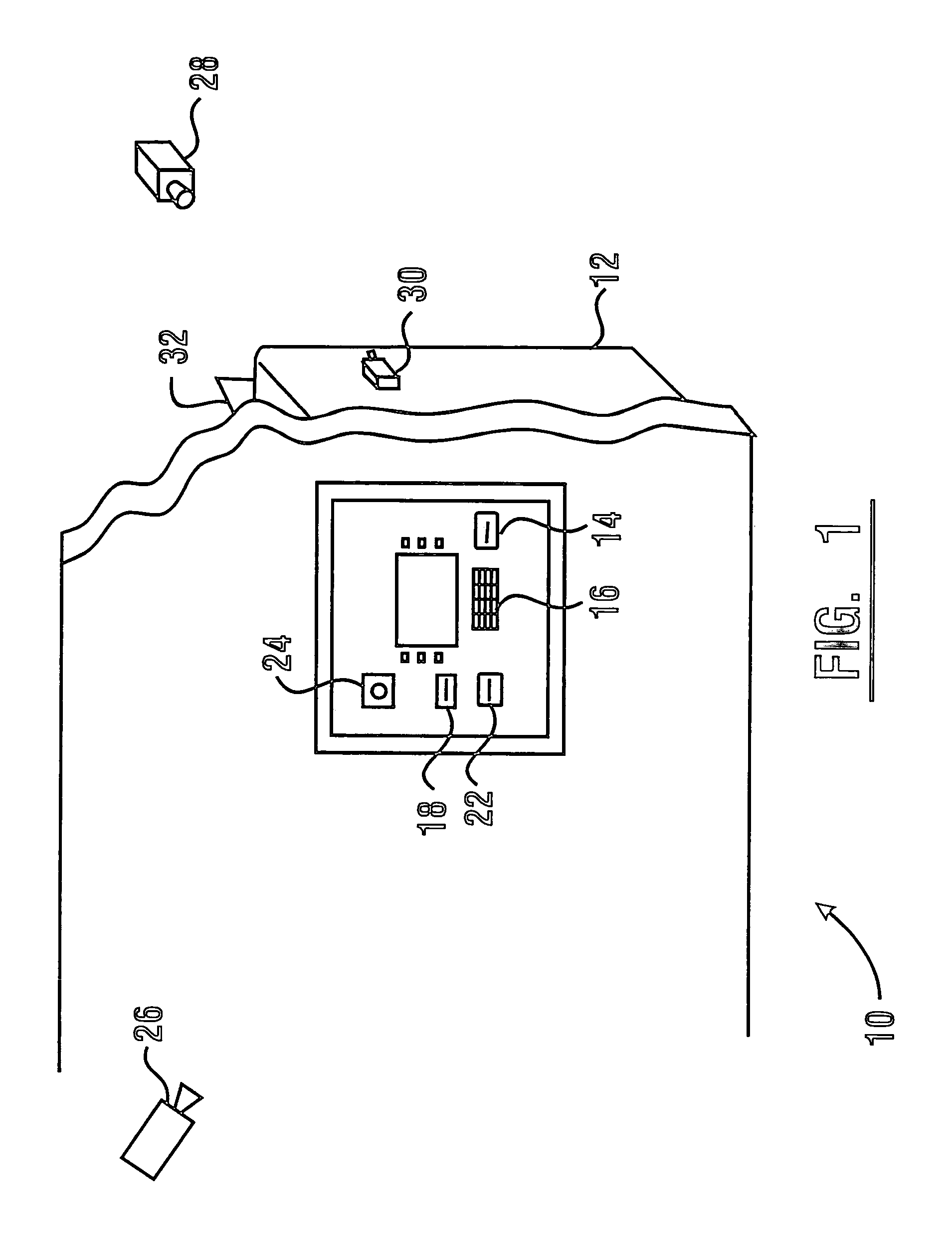

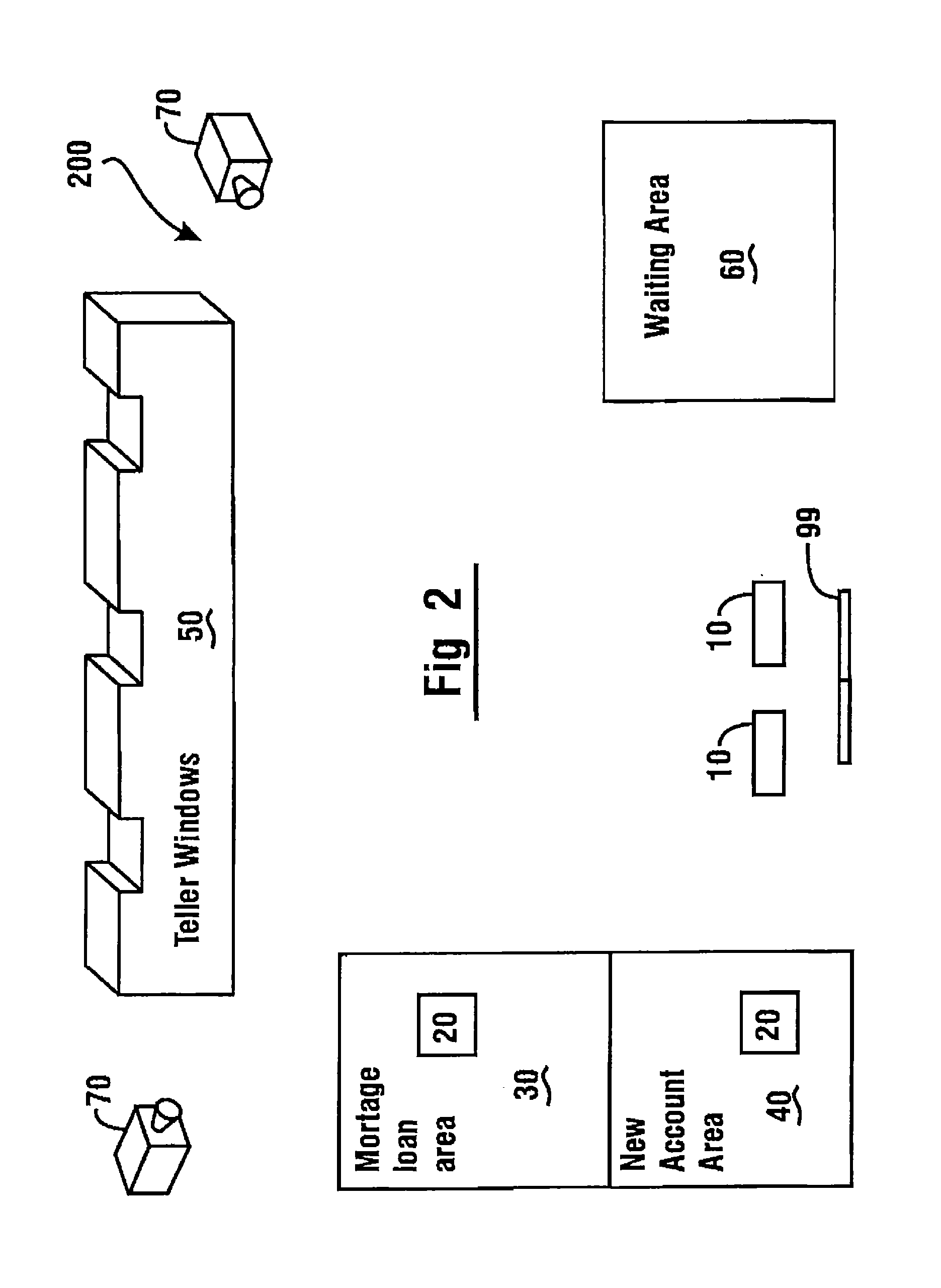

An automated merchant banking apparatus (10) is operative to carry out banking transactions commonly required by merchants. The apparatus includes a user interface (18) which includes a plurality of input and output devices. The apparatus further includes a rolled coin dispenser (40) for dispensing various denominations of rolled coin. The rolled coin dispenser includes a coin roll presenter and retraction unit (42) which is operative to retract coin rolls which have been dispensed into holding areas (177) into a storage area (176) in the machine.

Owner:DIEBOLD NIXDORF

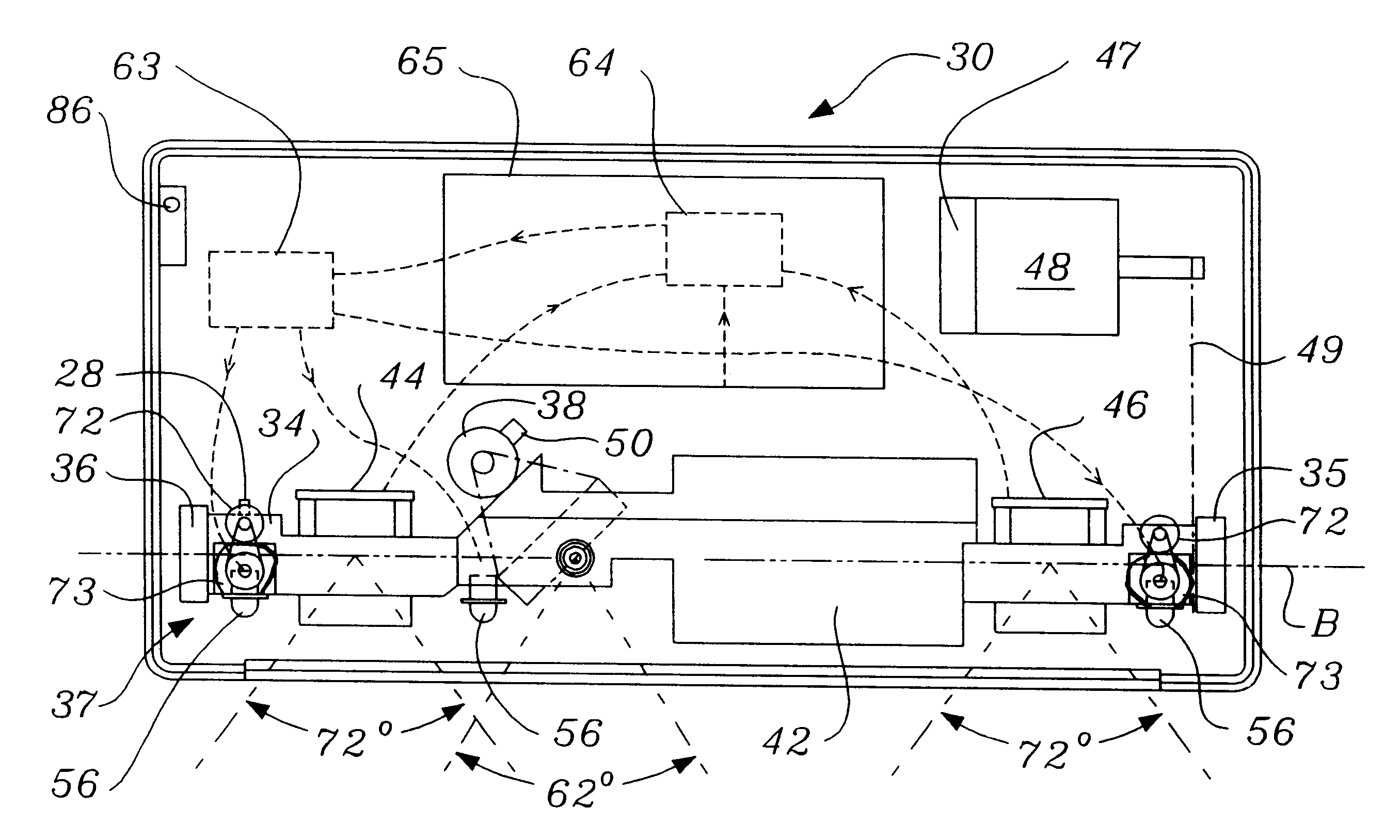

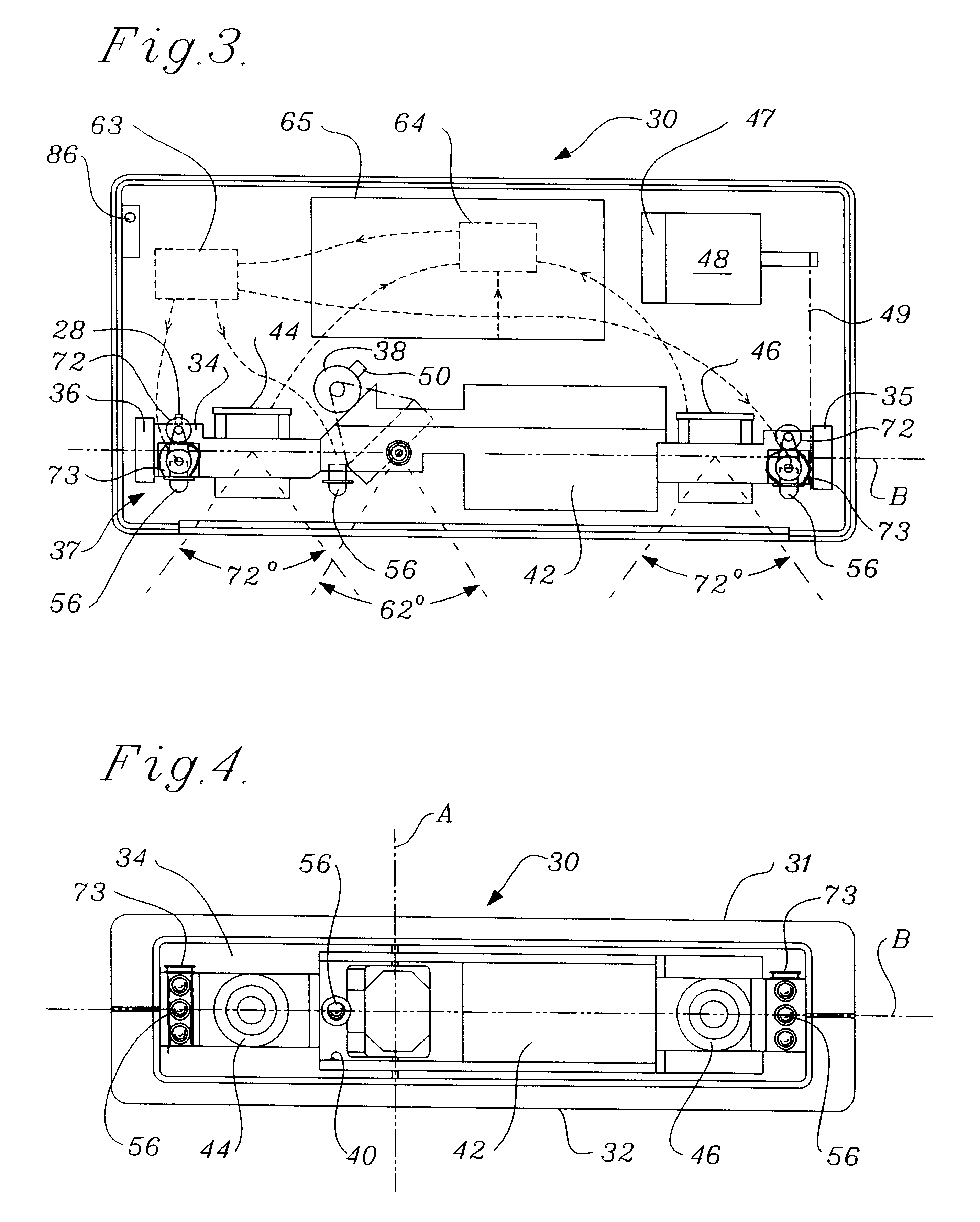

Compact imaging device incorporating rotatably mounted cameras

A compact image steering and focusing device has a generally rectangular frame containing at least one illuminator and at least one and preferably two cameras and a pan / tilt mirror on a tilting frame. There is a tilt axis through the frame. A tilt motor is attached to the frame to turn the frame about the tilt axis. Another camera is positioned in optical alignment with the pan / tilt mirror. The device can fit behind the cover plate of an automated teller machine. Images from the cameras on the titling frame are used to focus the other camera on one eye of the automated teller machine user to identify the user by iris analysis and comparison to an iris image or iris code on file.

Owner:SENSAR

System and method for capturing and searching image data associated with transactions

A system and method is carried out in connection with a card actuated automated banking machine. The automated banking machine is operative to dispense cash to users. An imaging device in the automated banking machine is operative to capture data corresponding to images of checks. At least one computer in the automated banking machine operates to produce markup language documents including data corresponding to indicia included on checks received by the machine. Markup language documents produced by the automated banking machine are communicated to a remote check analysis terminal.

Owner:DIEBOLD NIXDORF

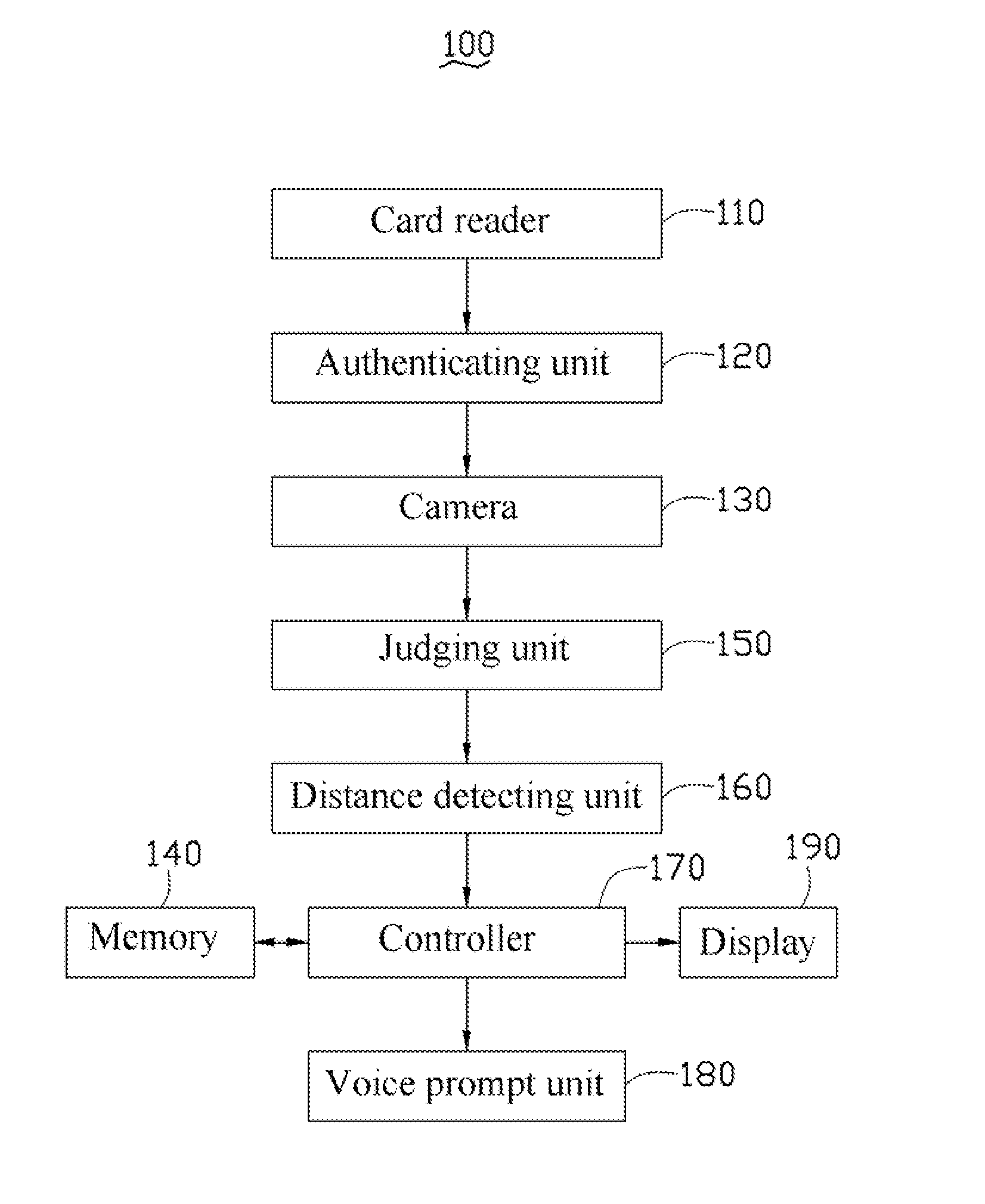

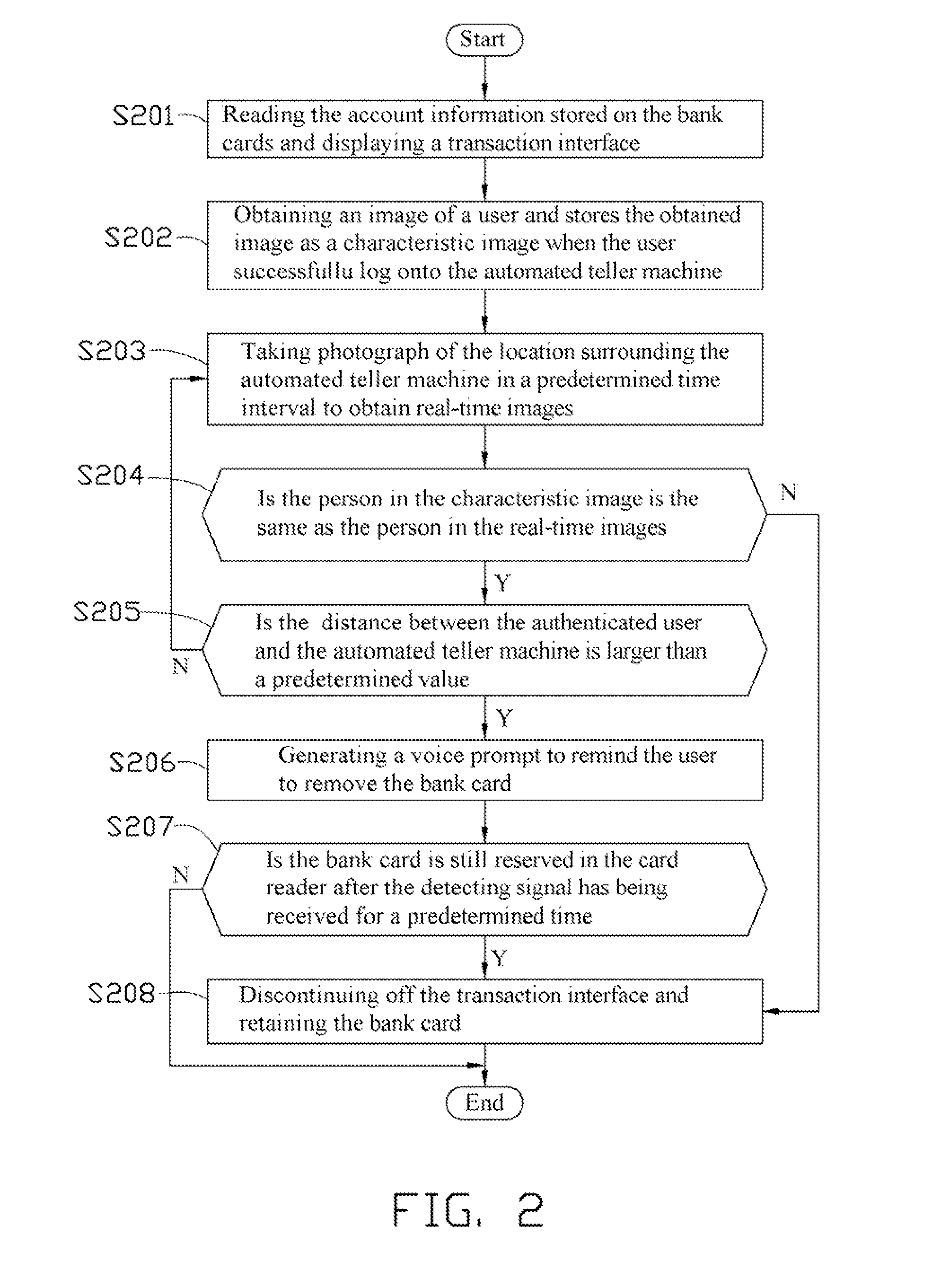

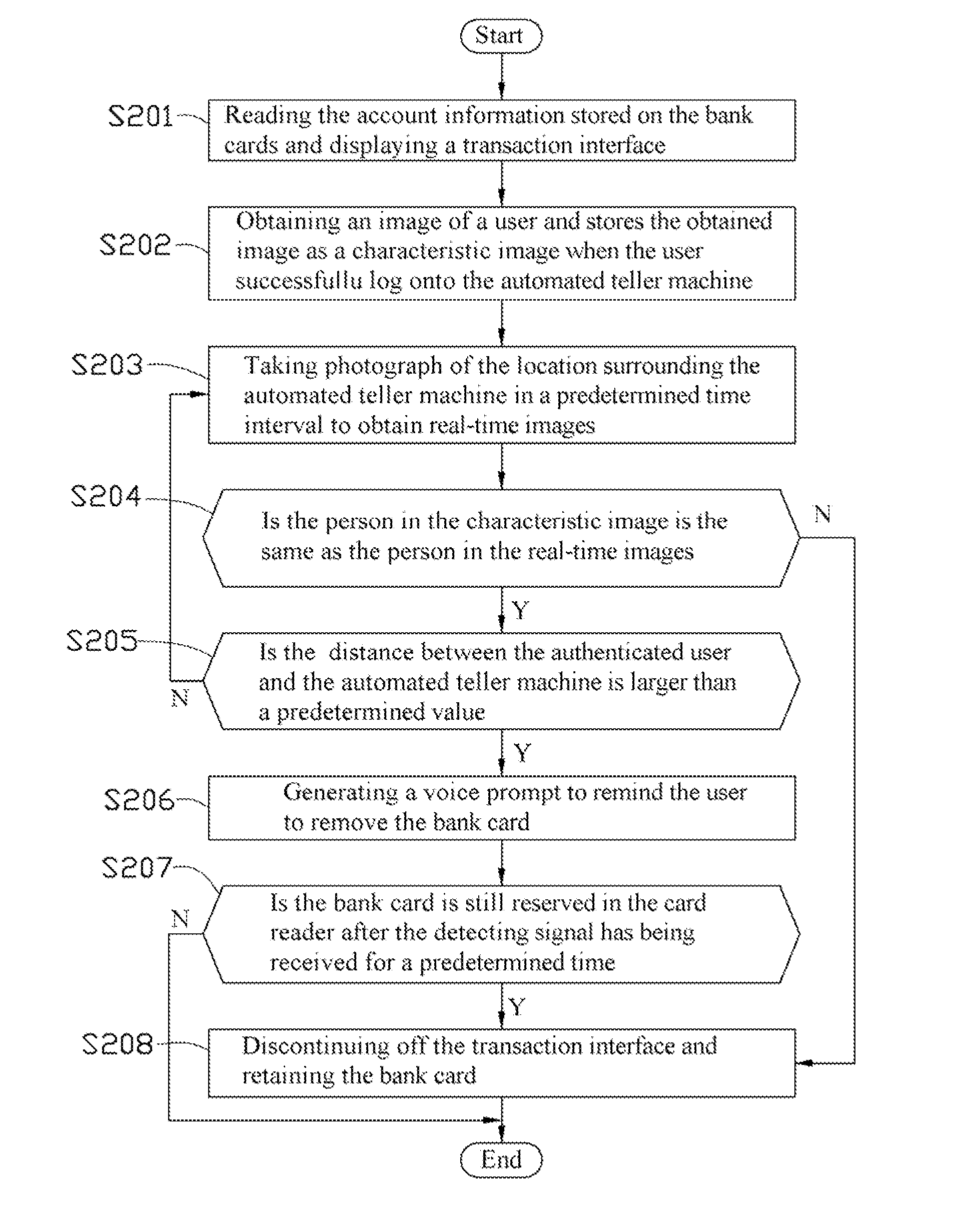

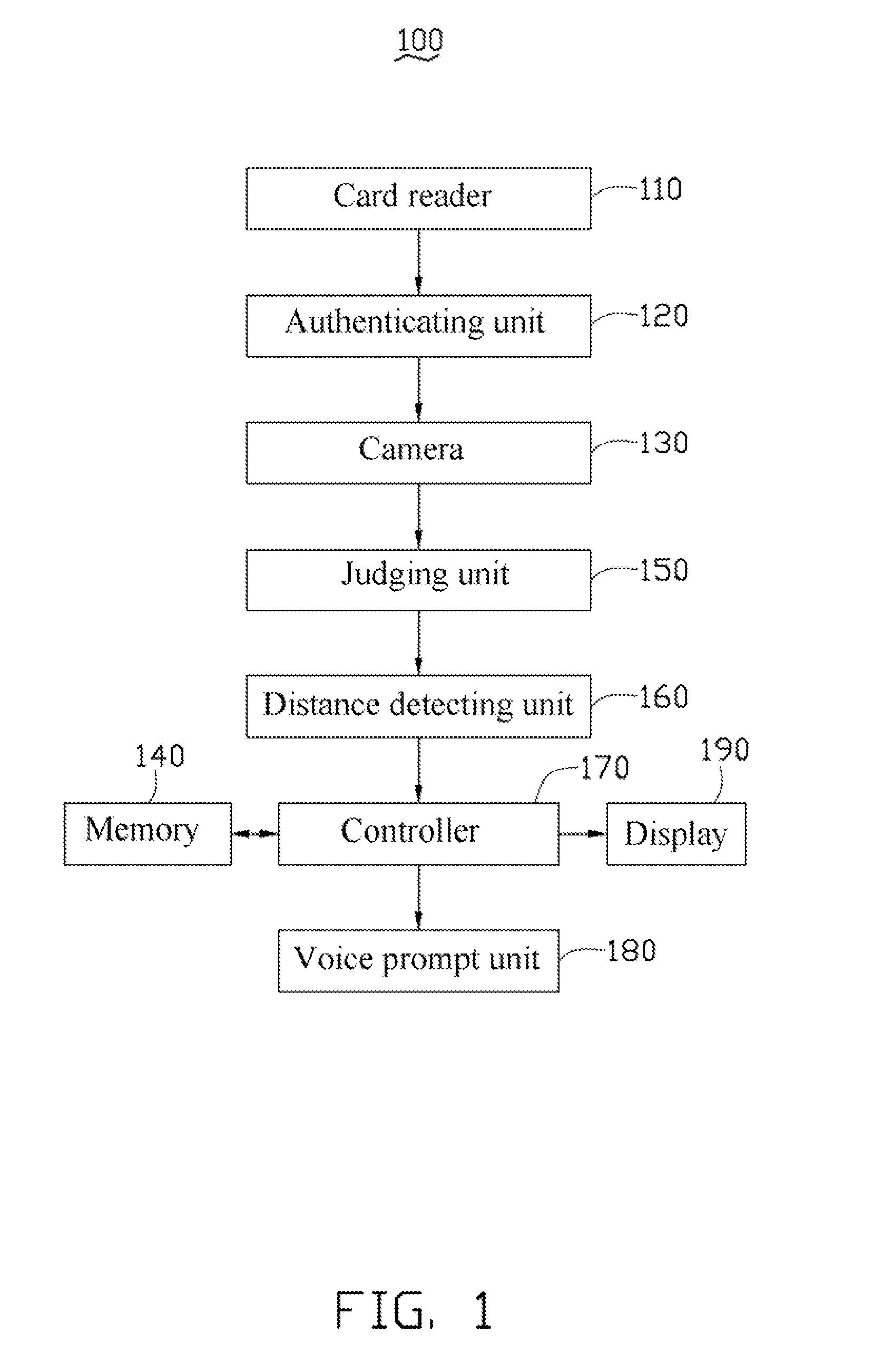

Automated teller machine and voice prompt method thereof

A voice prompt method includes obtaining an image of a user and storing the obtained image as a characteristic image when users successfully log onto an automated teller machine; taking photographs of the location surrounding the automated teller machine at predetermined time intervals to obtain real-time images; judging whether the person of the characteristic image is the same as the person in the real-time image; detecting whether the distance between the user and the automated teller machine is larger than a predetermined value if the person in the two images is judged to be the same; and generating a voice prompt to remind the user not to forget to remove his / her bank card if the distance between the user and the automated teller machine becomes larger than a predetermined value. An automated teller machine is also provided.

Owner:FU TAI HUA IND SHENZHEN +1

Automated teller machine and voice prompt method thereof

Owner:FU TAI HUA IND SHENZHEN +1

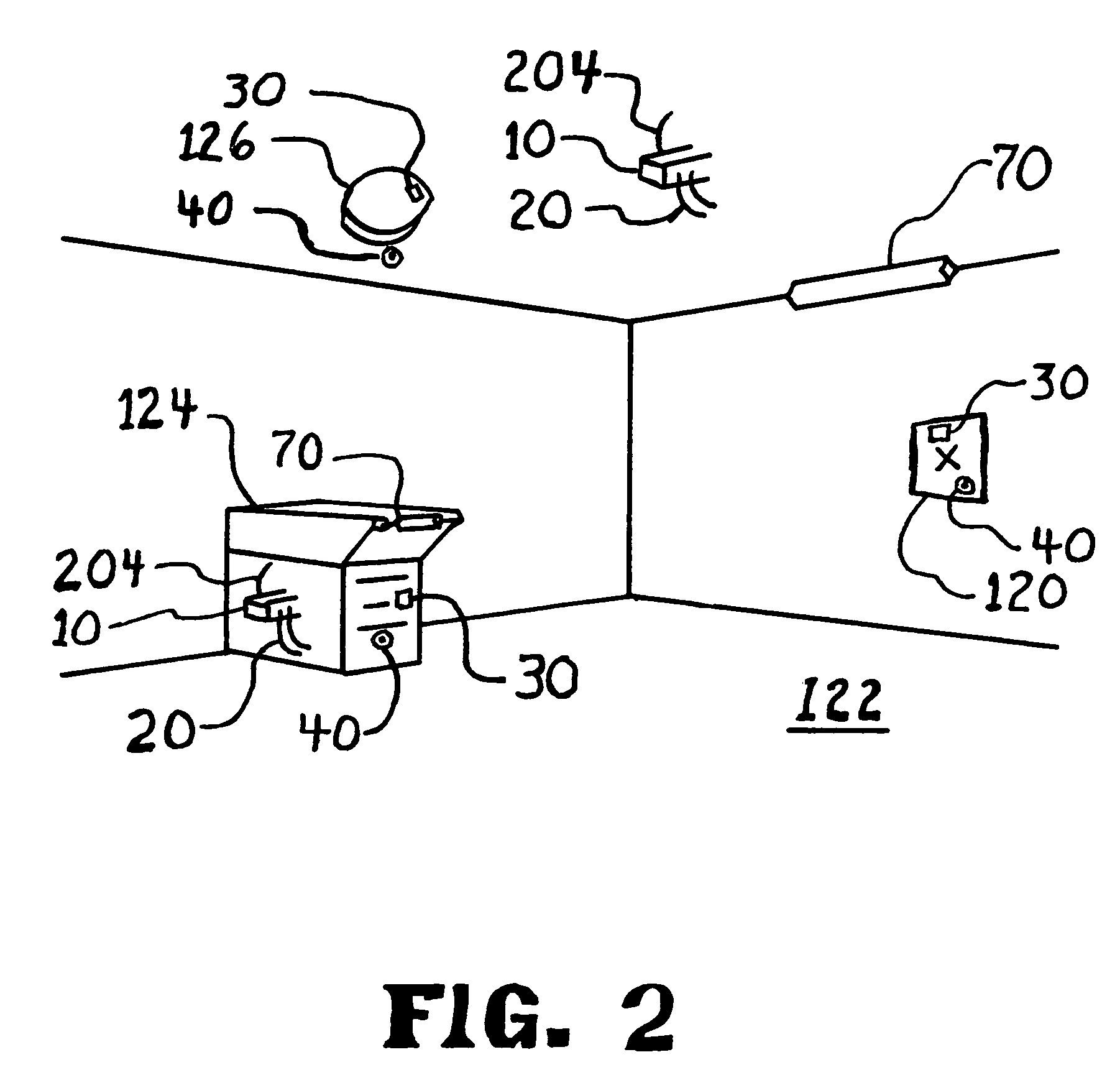

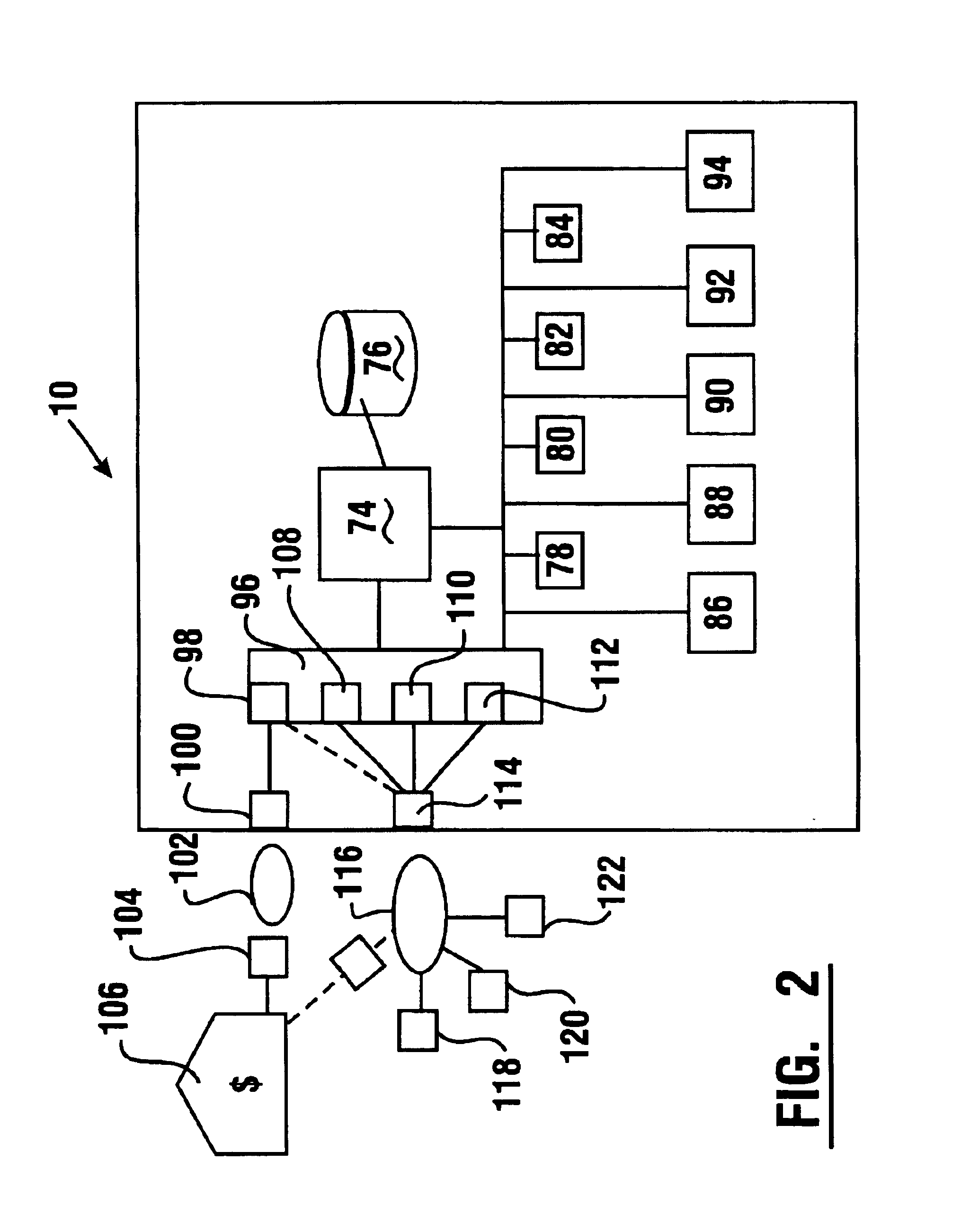

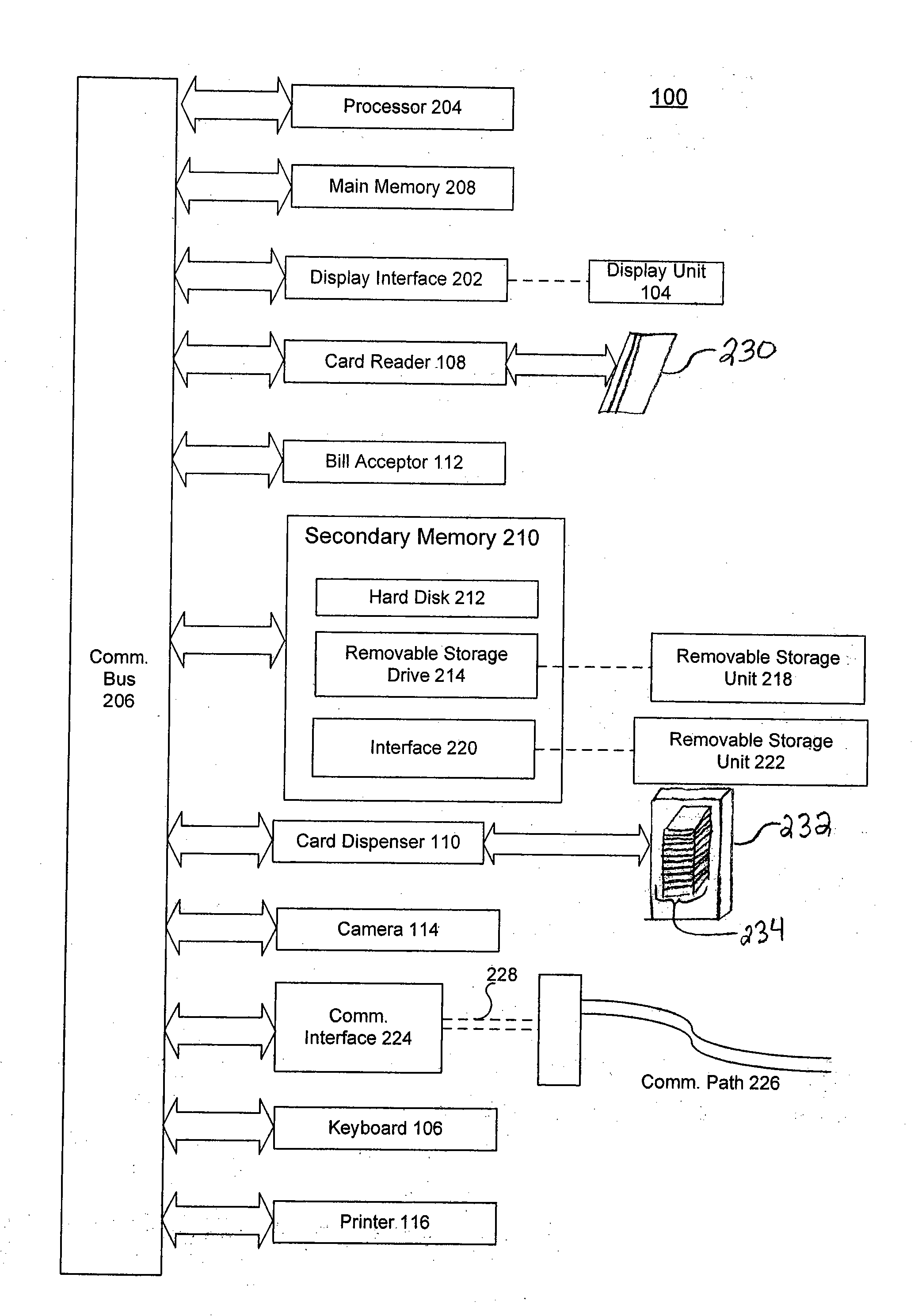

Automated banking machine system and method

ActiveUS8396766B1Programmed more readilyEasy programmingFinanceATM surveillanceImaging conditionComputer graphics (images)

A system and method captures image data in association with the operation of an automated banking machine. Image data associated with users and documents may be acquired, analyzed and transferred. Images may be captured responsive to programmed sequences. The sequences may be performed on a periodic basis as well as in response to inputs corresponding to alarm conditions and transactions conducted at automated banking machines or other devices. Image data may also be captured in response to image conditions including the sensing of motion or the loss of usable video from selected cameras. Image data may be stored in connection with data corresponding to circumstances associated with each triggering event. Stored image data may be searched by one or more parameters. Parameters may include data stored in association with each image, types of events causing image data to be stored, as well as other image conditions and properties.

Owner:DIEBOLD NIXDORF

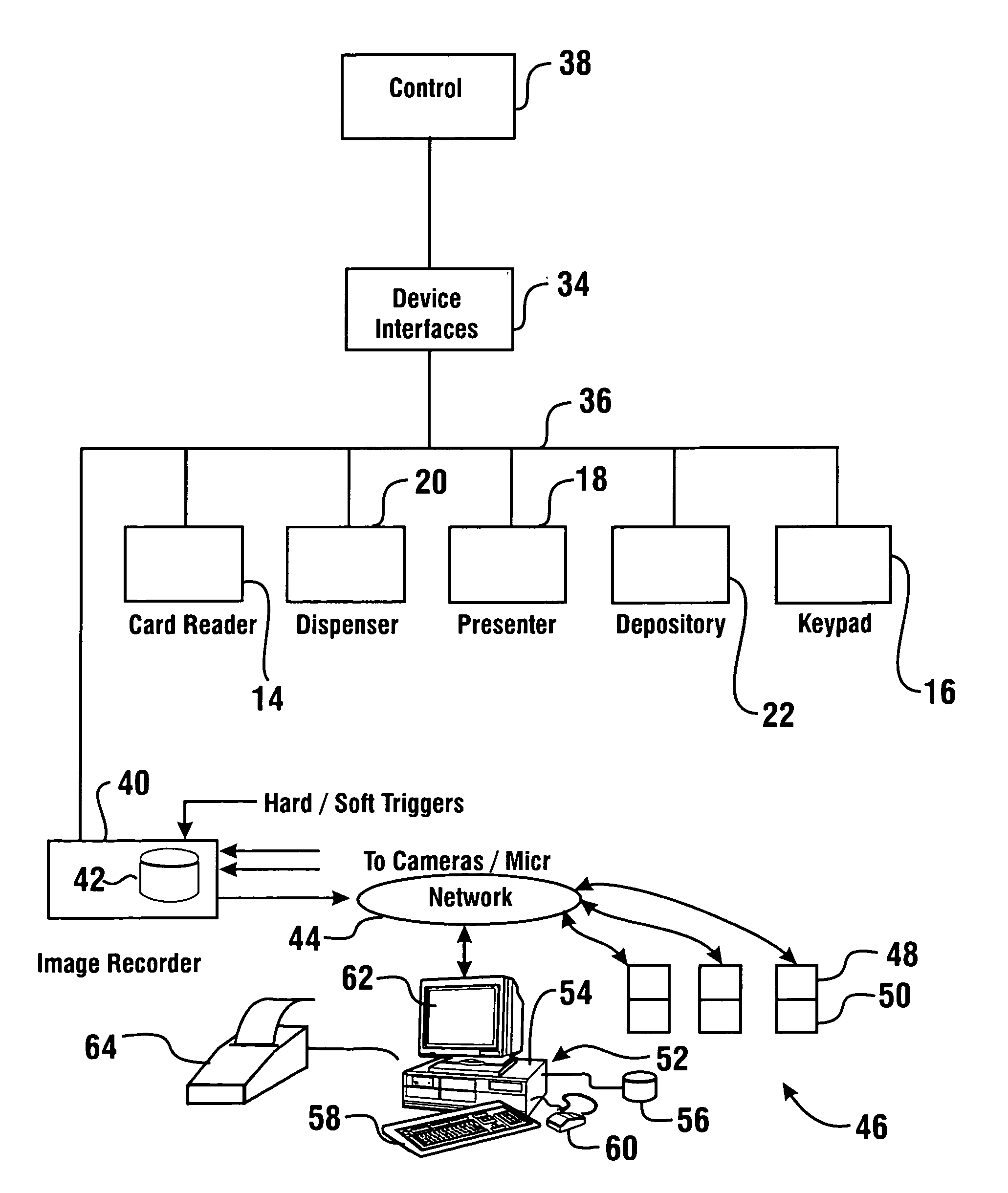

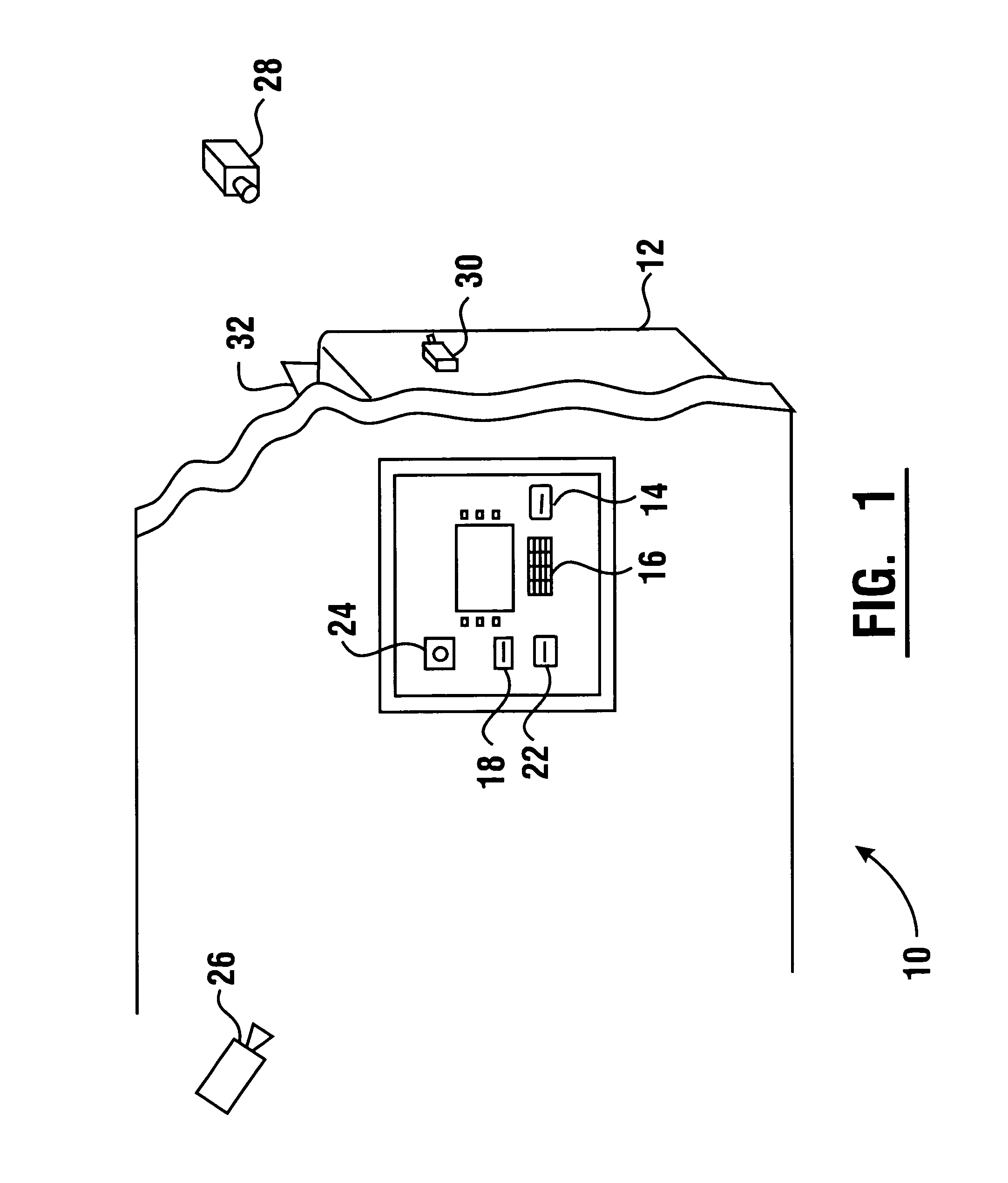

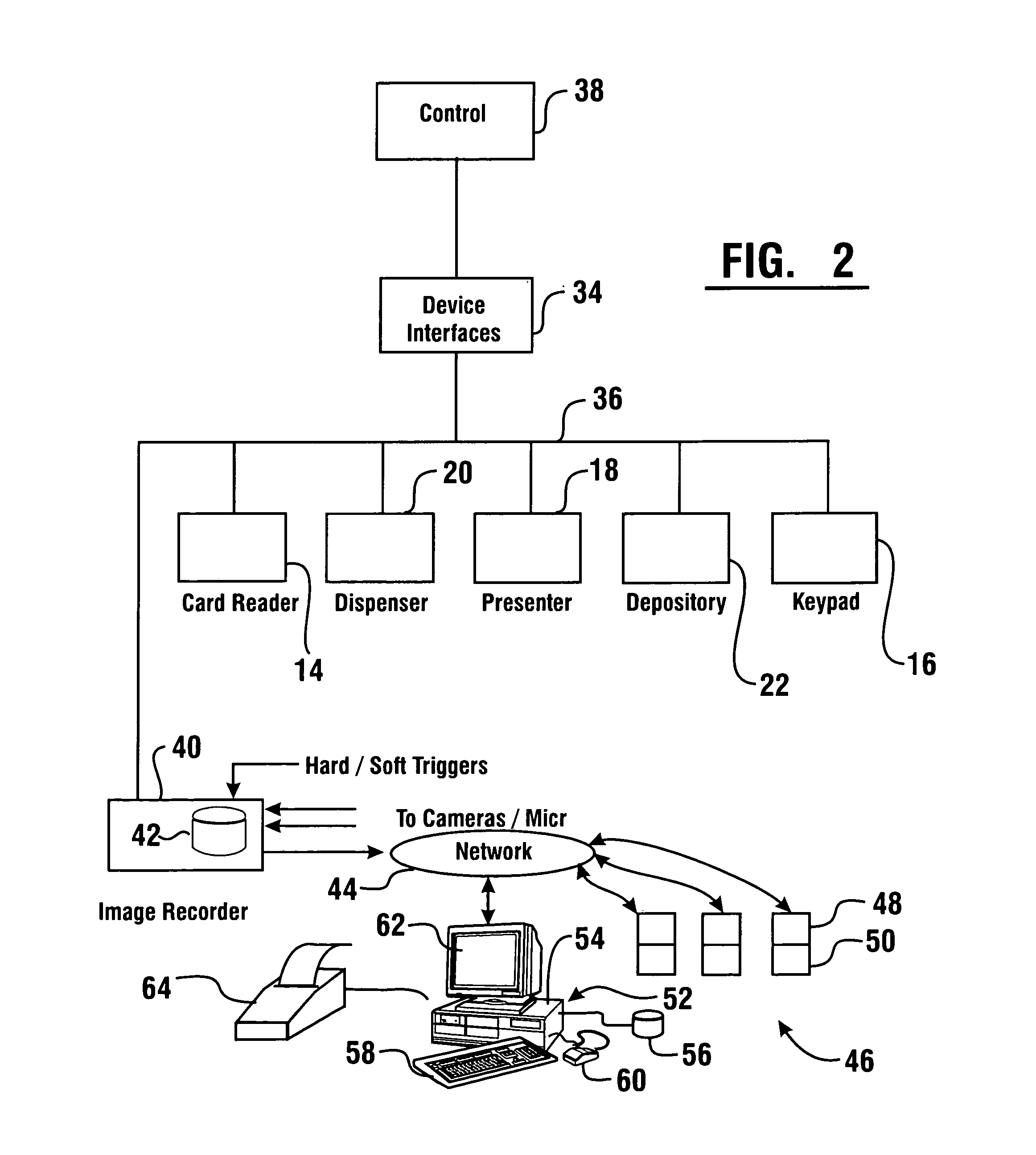

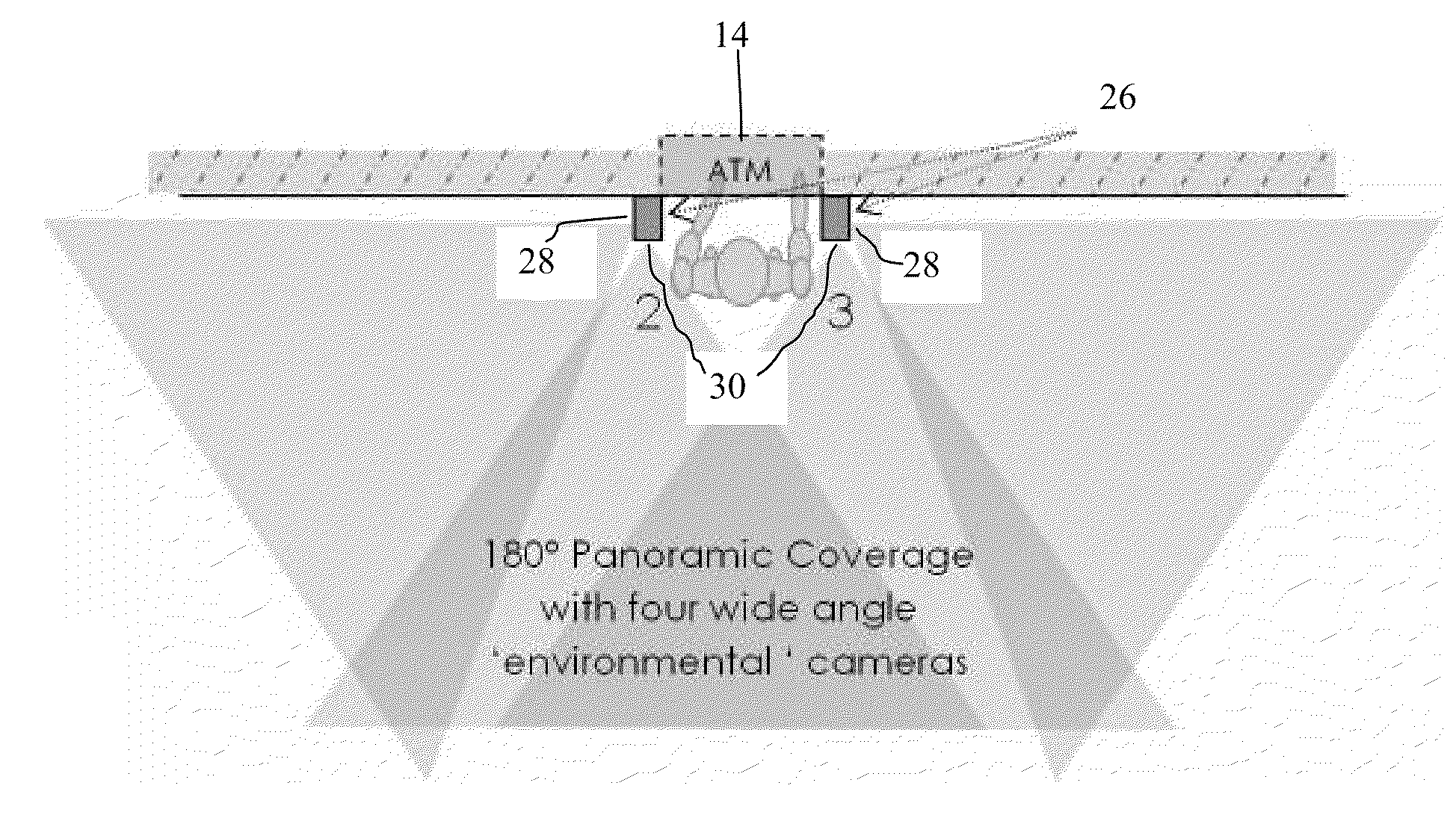

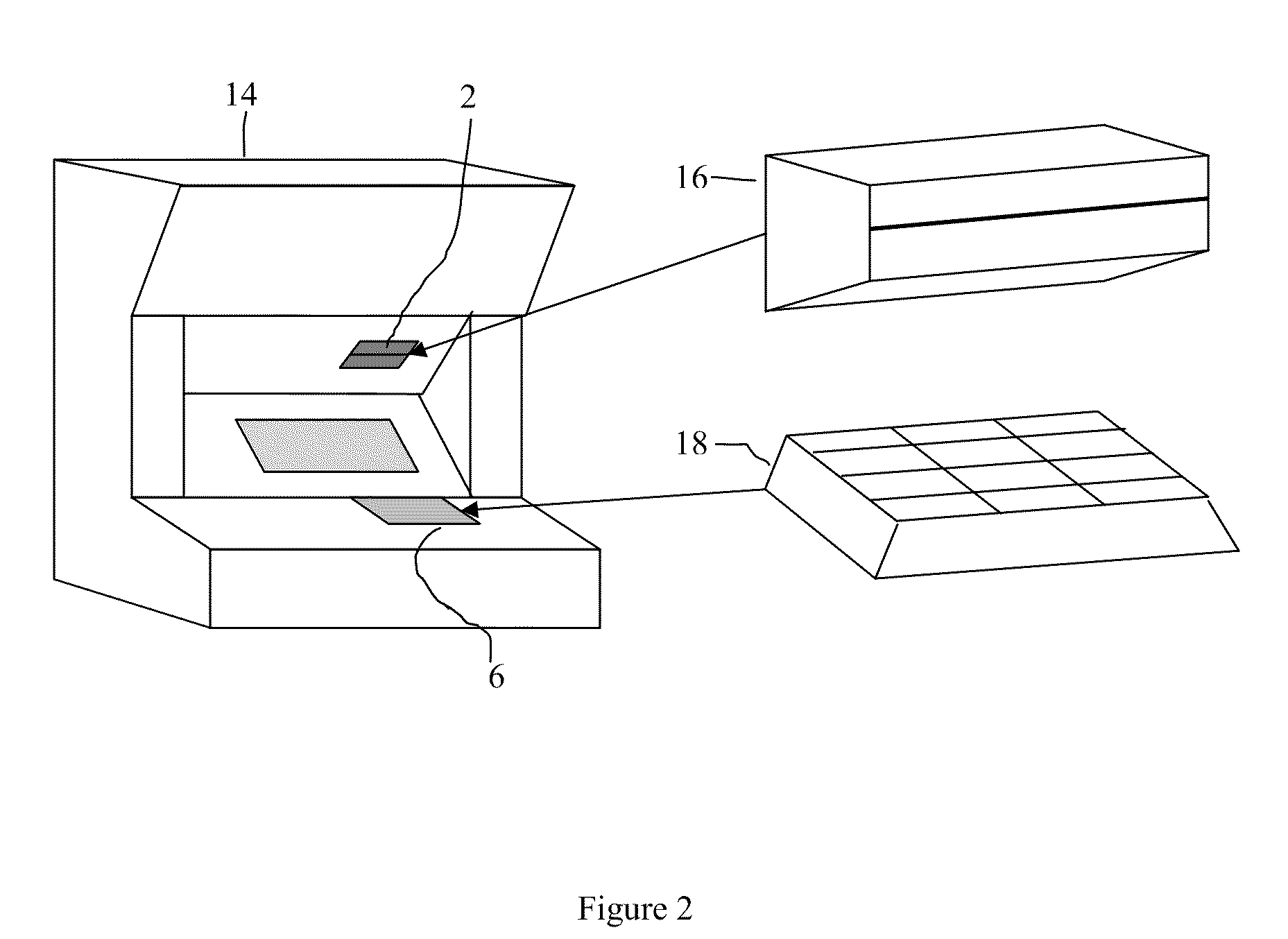

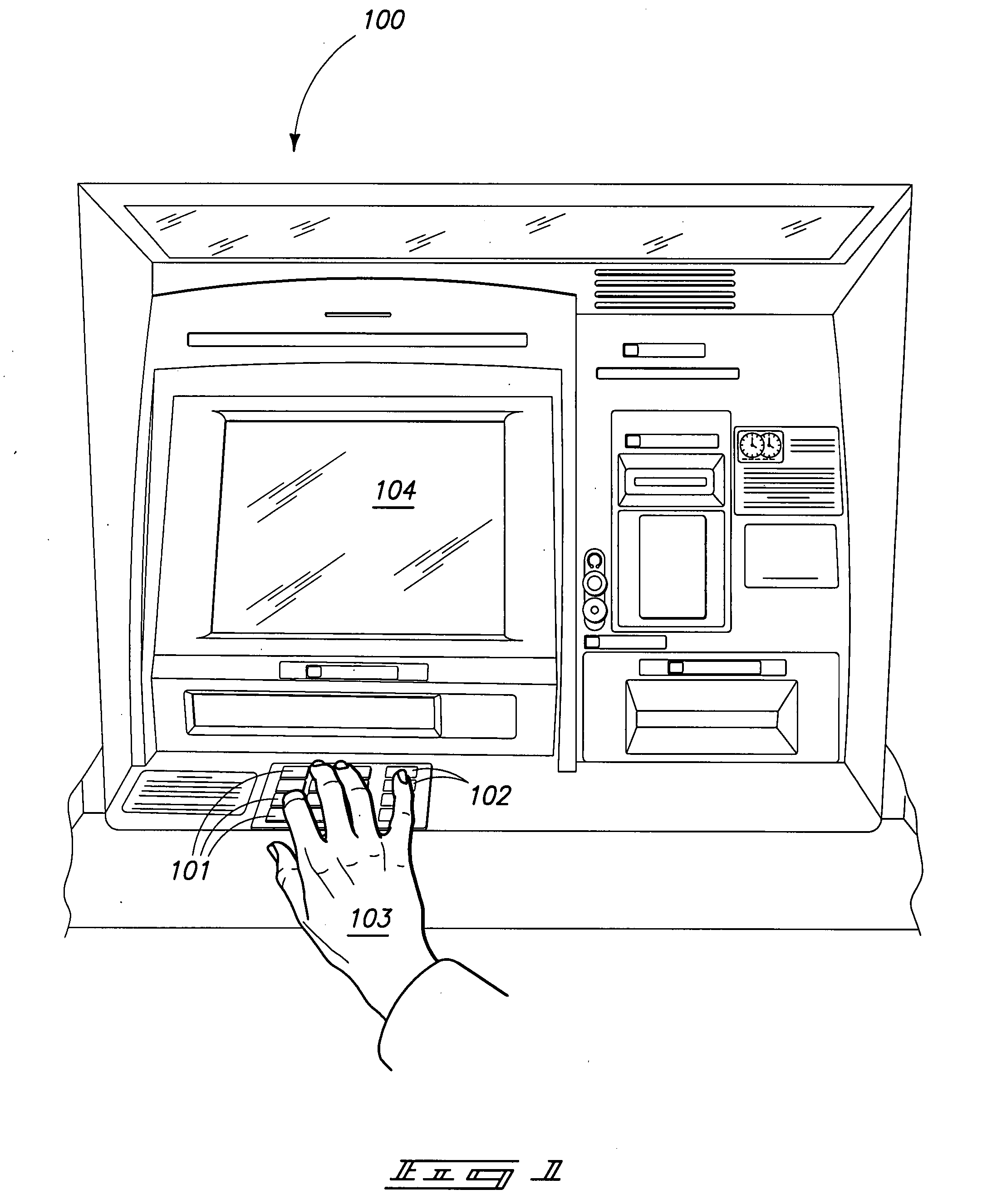

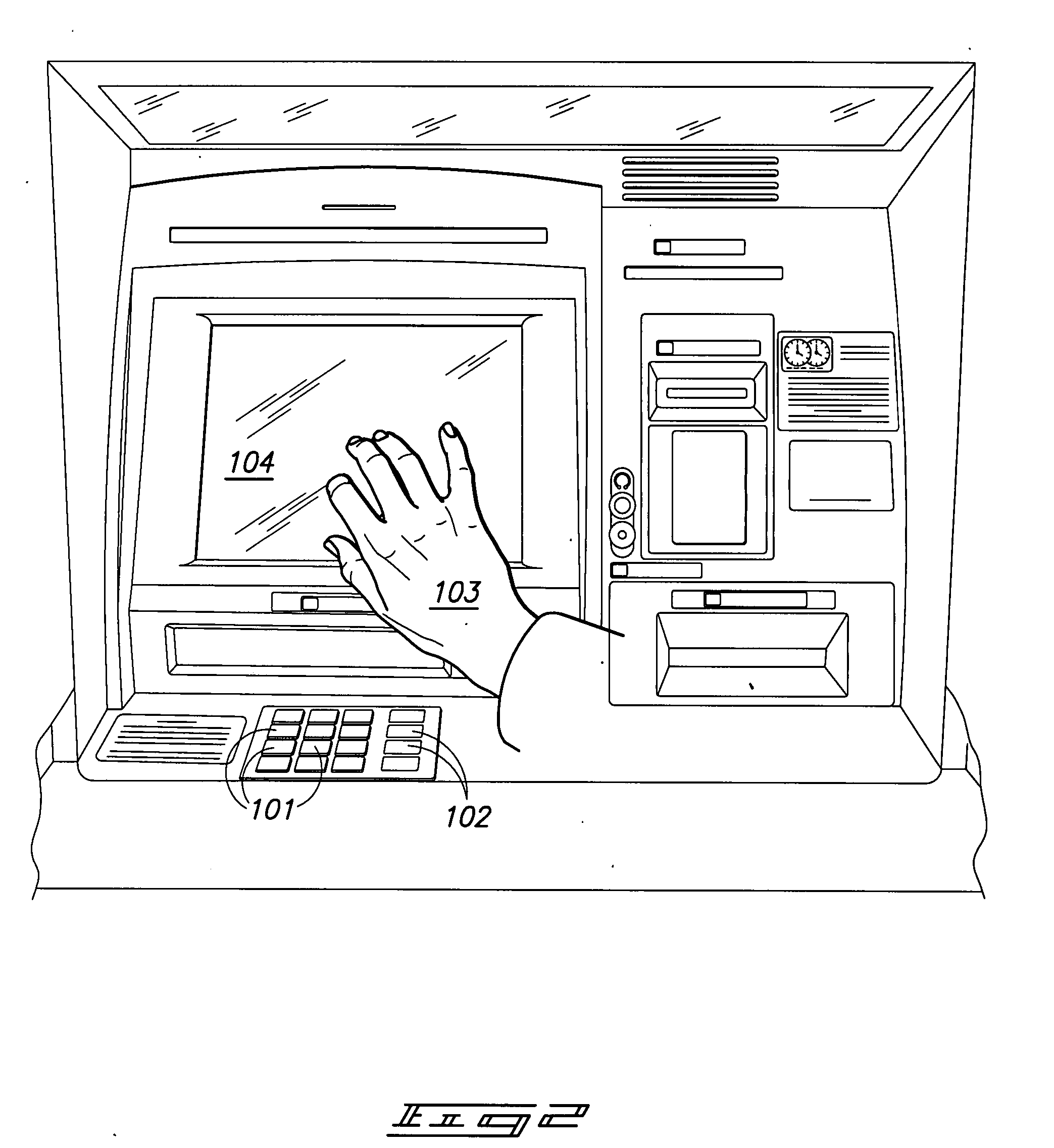

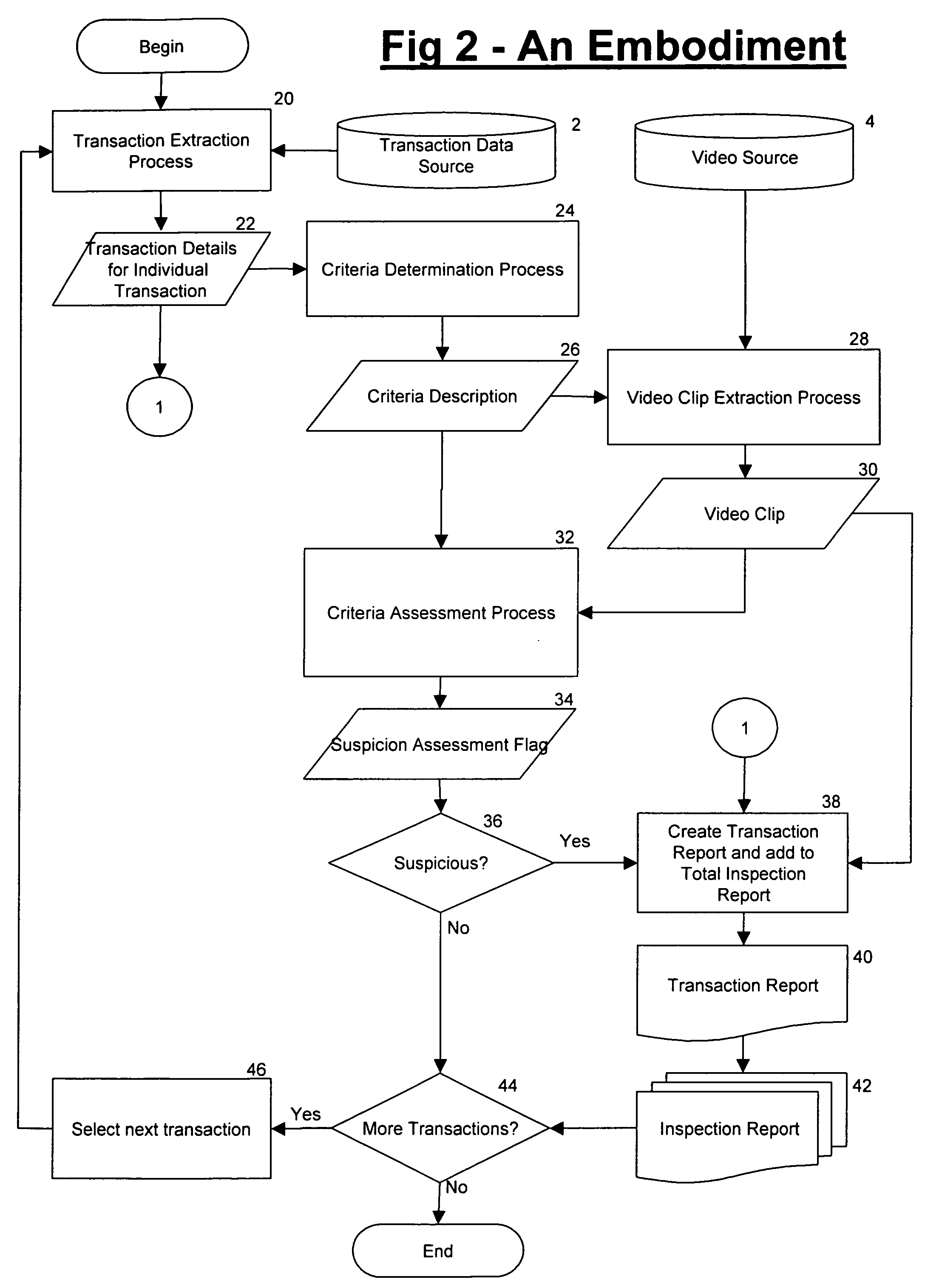

Method and apparatus for integrated ATM surveillance

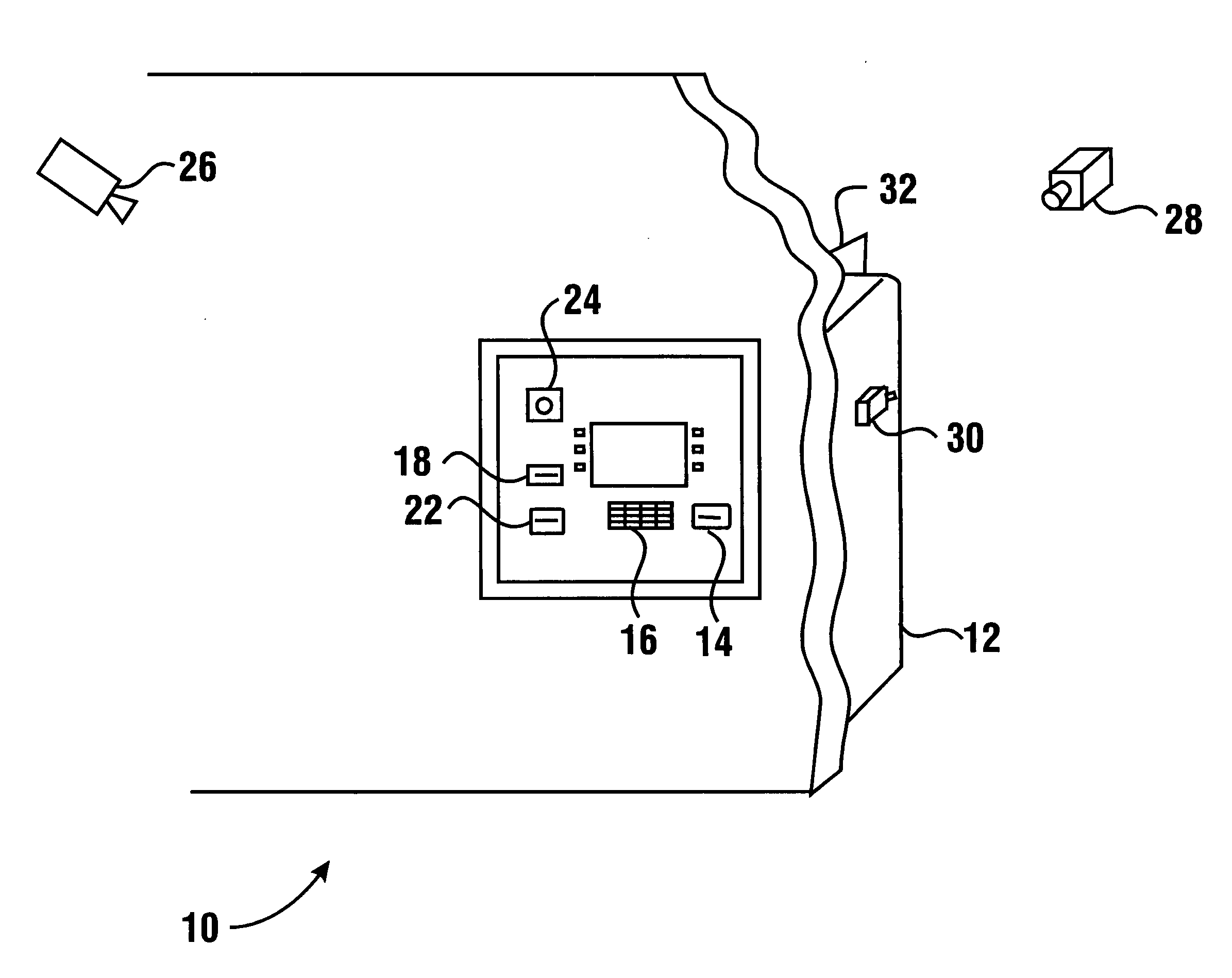

InactiveUS20090201372A1Good effectReduce participationComplete banking machinesColor television detailsMonitoring systemCard reader

A method and apparatus for integrated ATM surveillance of an area of interest, such as an automated teller machine (ATM), is presented. An embodiment includes a surveillance system for an ATM utilizing multiple cameras aimed at the user, the card slot, the cash dispenser, the surrounding areas and internally in the card reader (to link the card used to the ATM user). The cameras are constantly powered and begin to record images after a sensor is activated. A buffer of recorded imagery is maintained such that when the sensors are activated, the video processing equipment can store a pre-defined amount of time before the sensor is activated. The buffer allows for the video capture of events just prior to the activation of the sensor. A time stamp and any other relevant data from the cameras may also be included with the stored recorded video.

Owner:FRAUDHALT

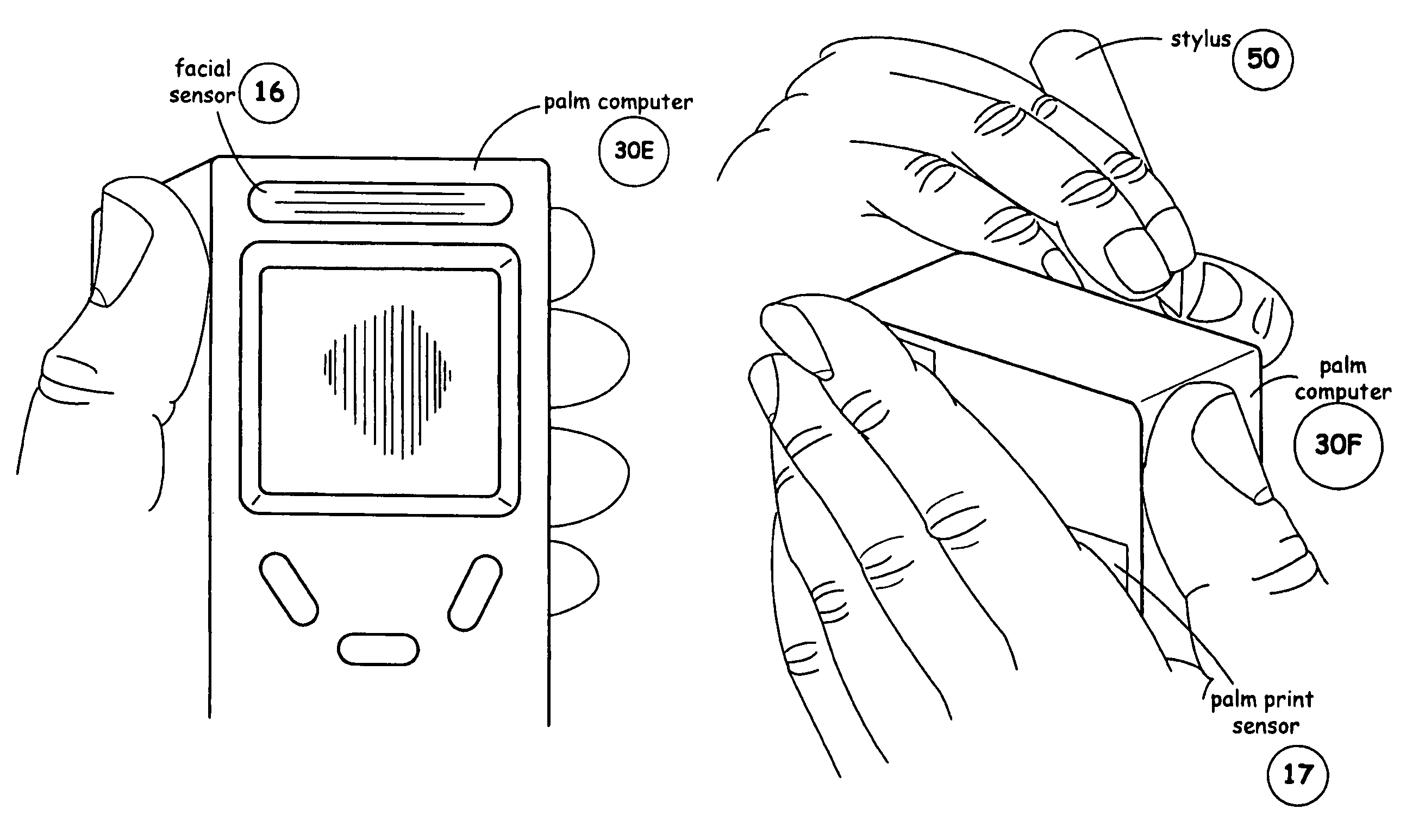

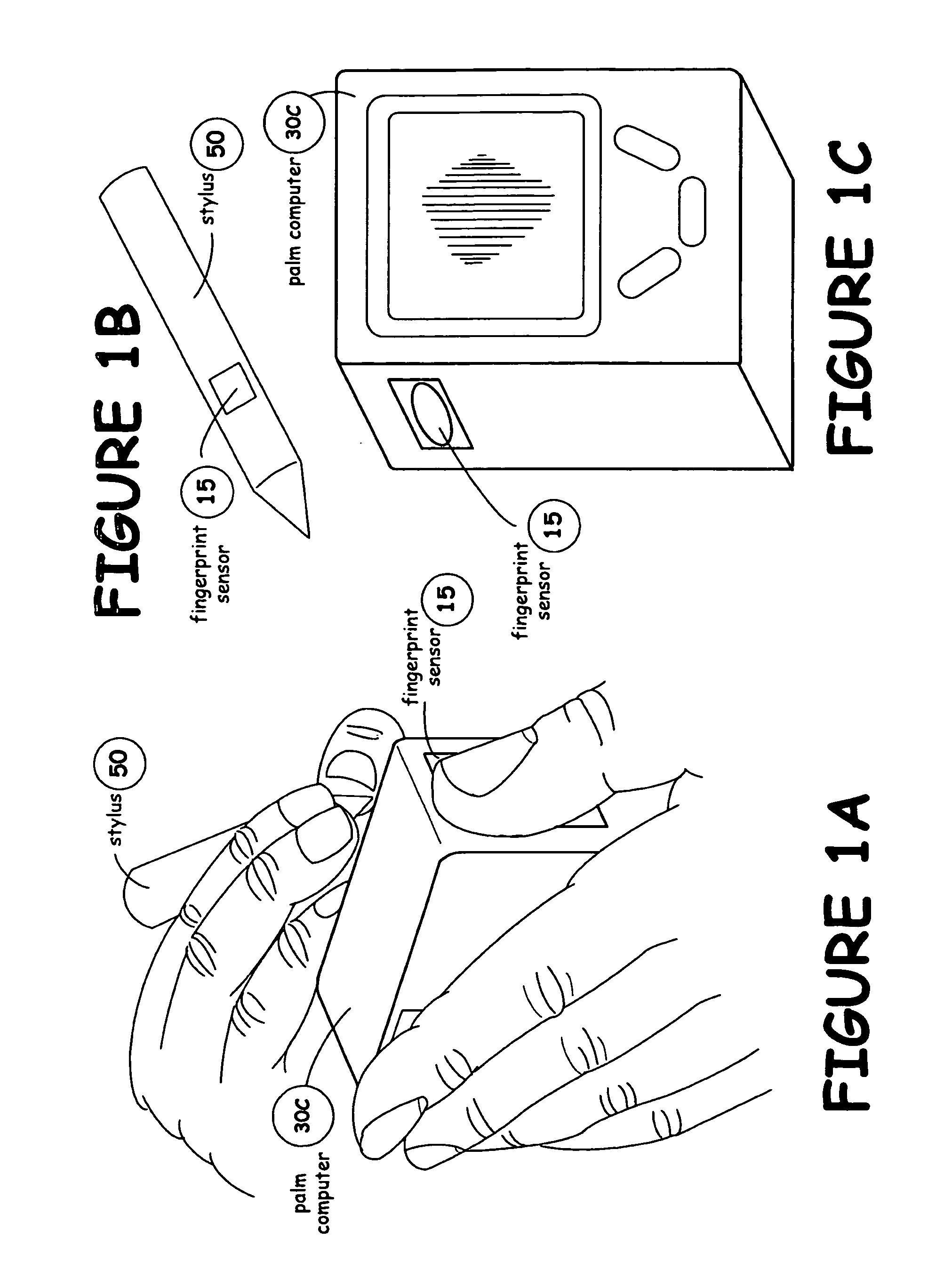

Data security system

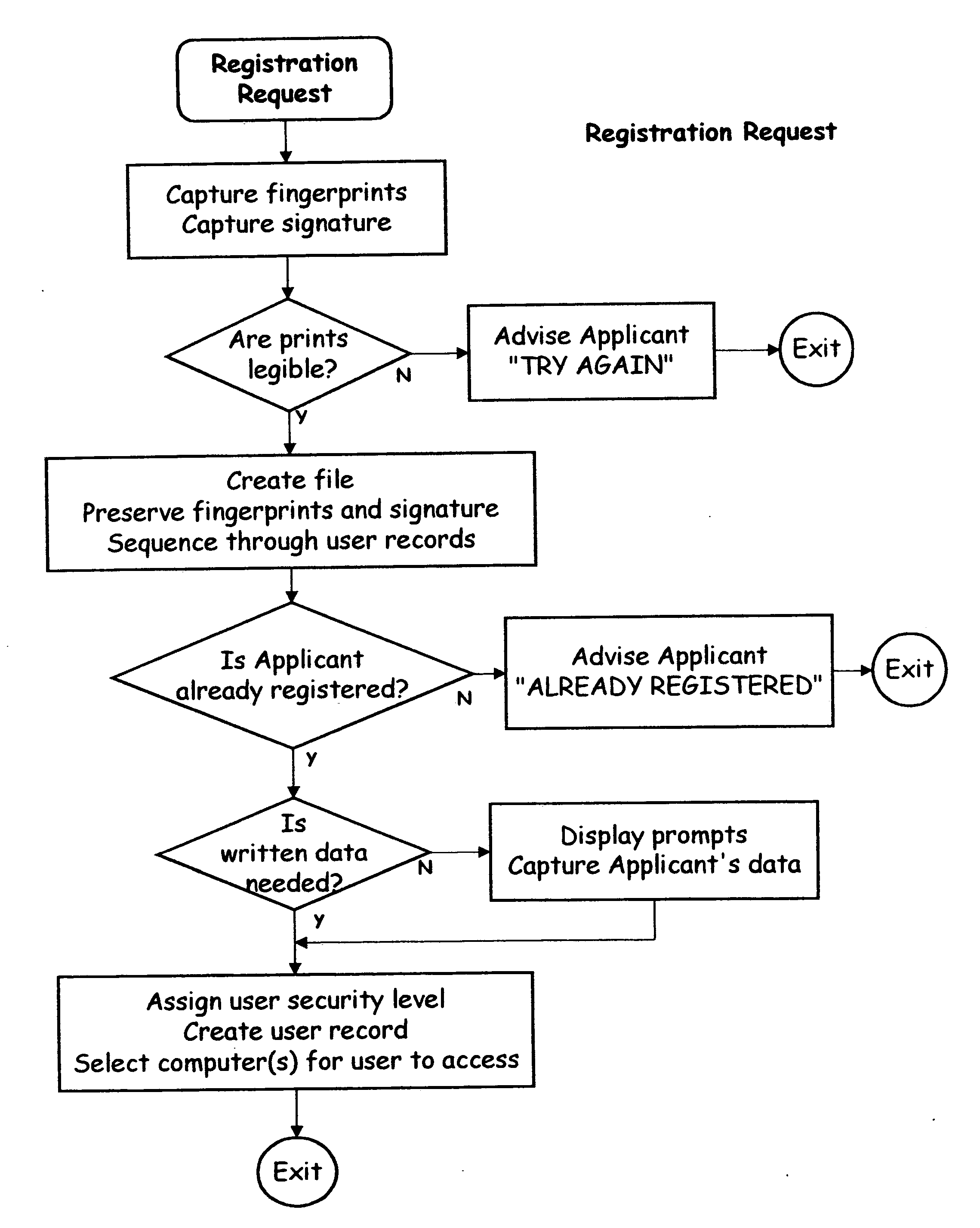

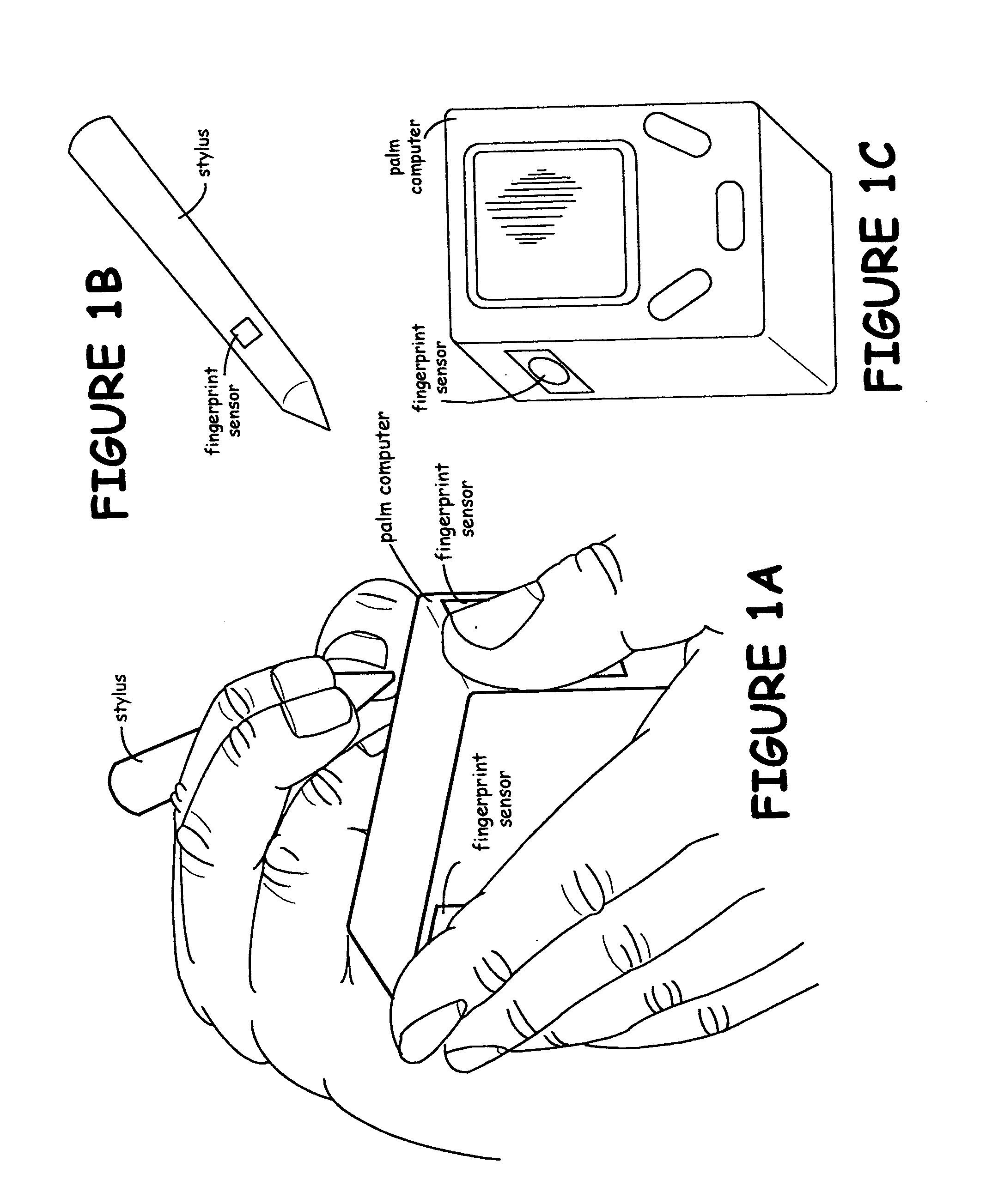

InactiveUS7047419B2Easy accessNeed can be addressedDigital data processing detailsInternal/peripheral component protectionComputer usageData access

A data security system comprises a host processor, and a plurality of remote computers. Each remote computer provides biometric authentication of a user prior to responding to the user request for data access. The remote computers are handheld when in operational mode. A sensor in the handheld computer captures a biometric image while the remote computer is being used. The biometric sensor is positioned in such a way that the sensor enables the capture of the biometric image continually during computer usage with each request for access to secure data. The biometric authentication occurs in a seamless manner and is incidental to the data request enabling user identity authentication with each request to access secure data.

Owner:UNITED STATES CP LLC

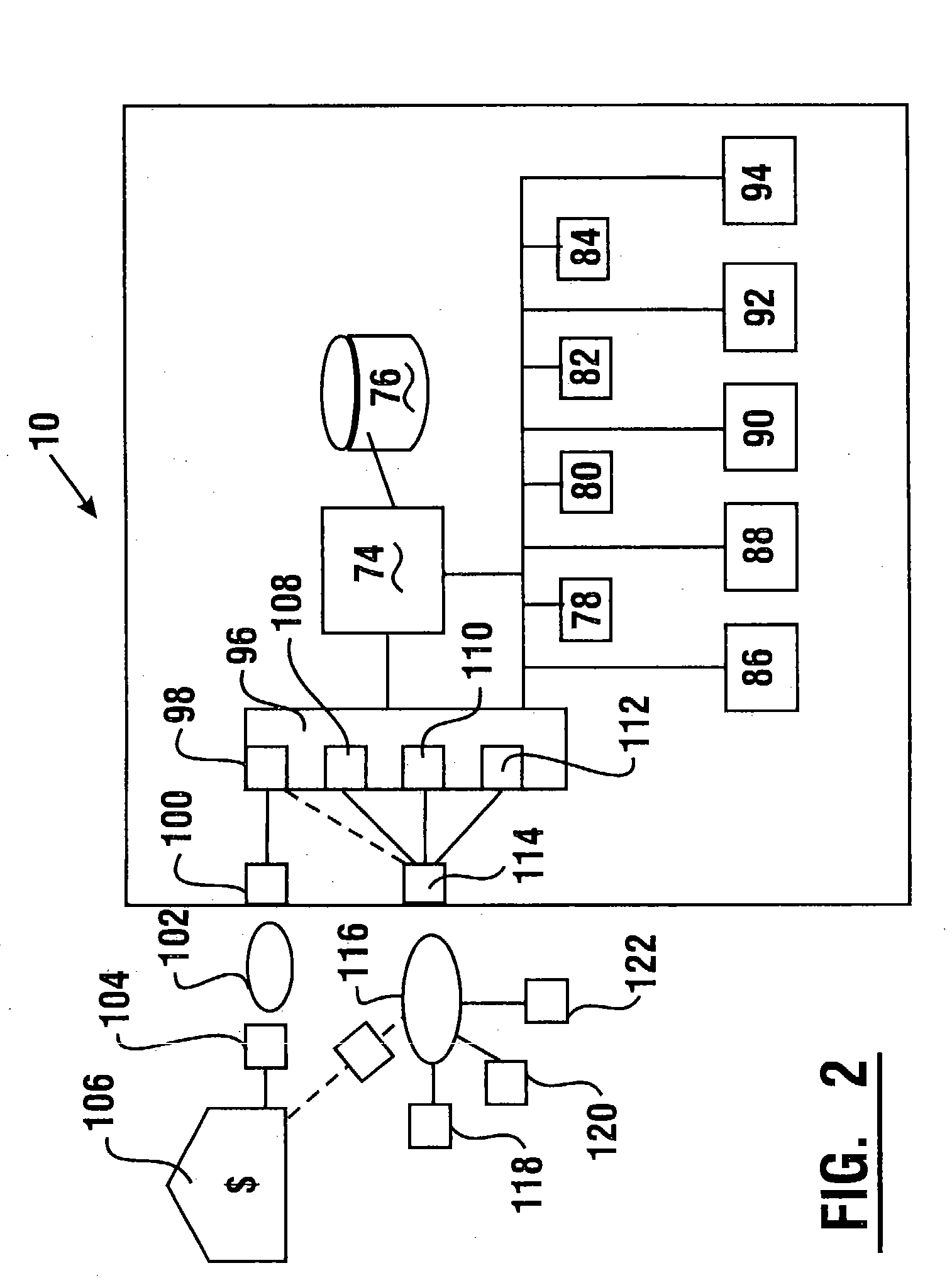

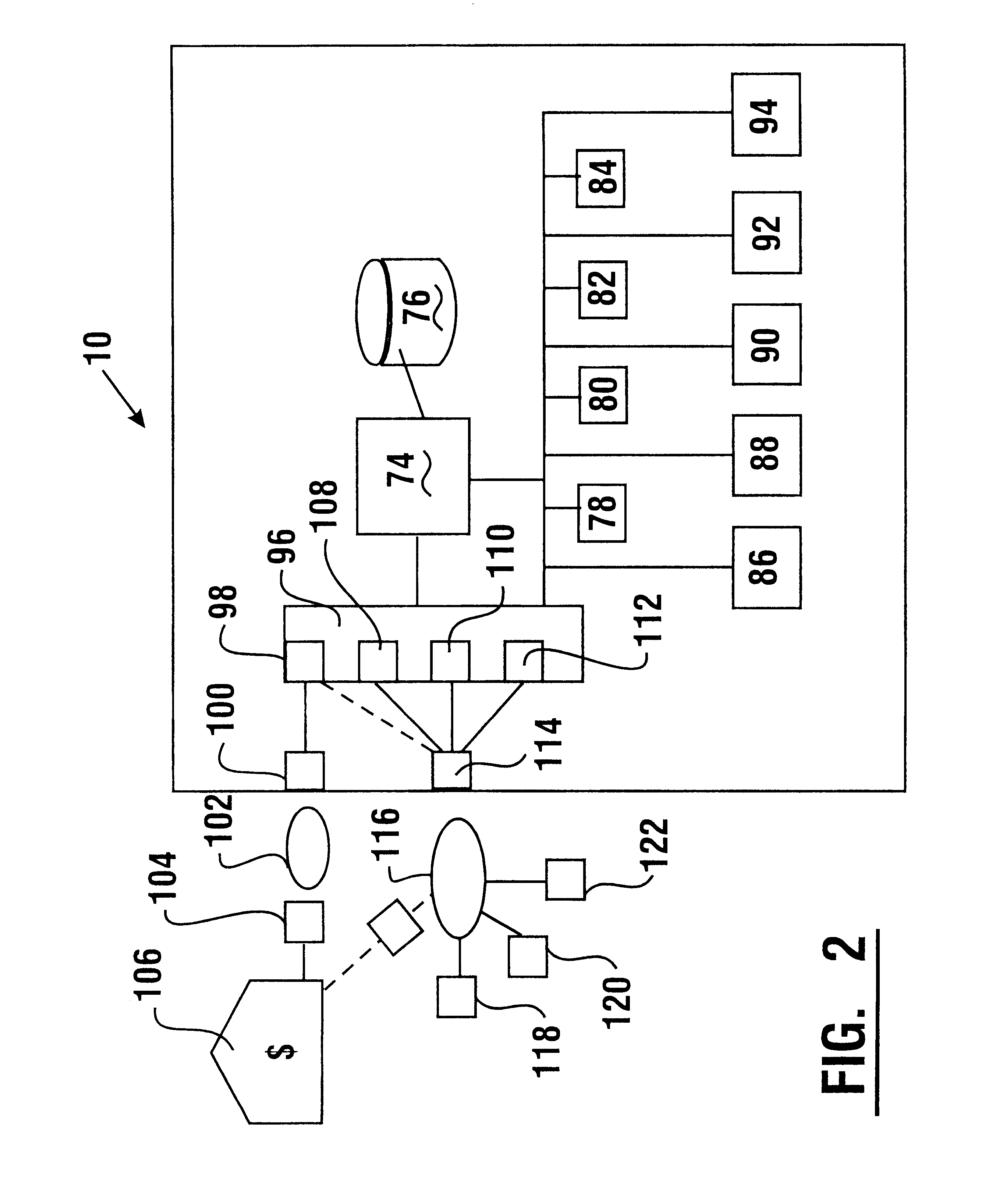

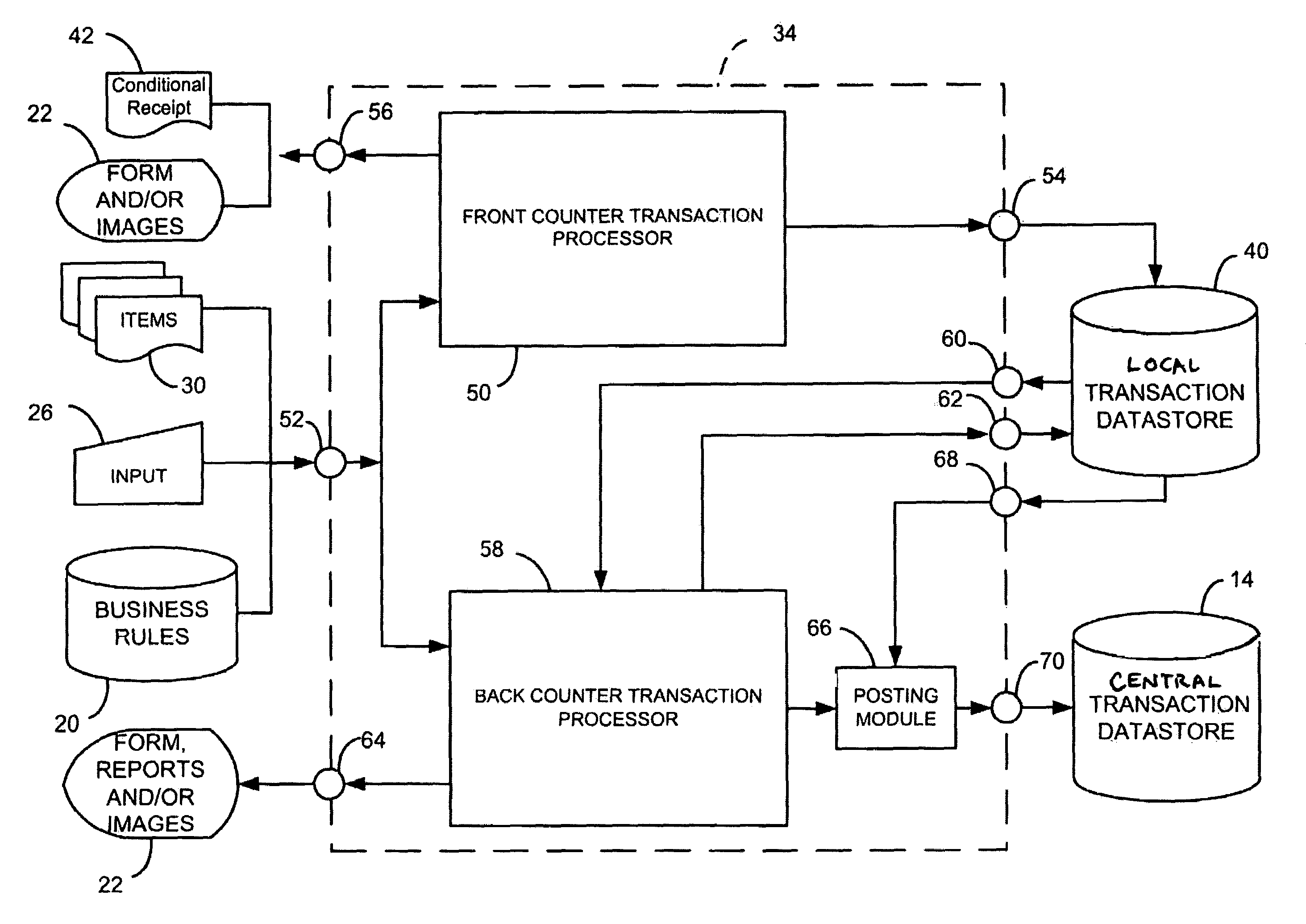

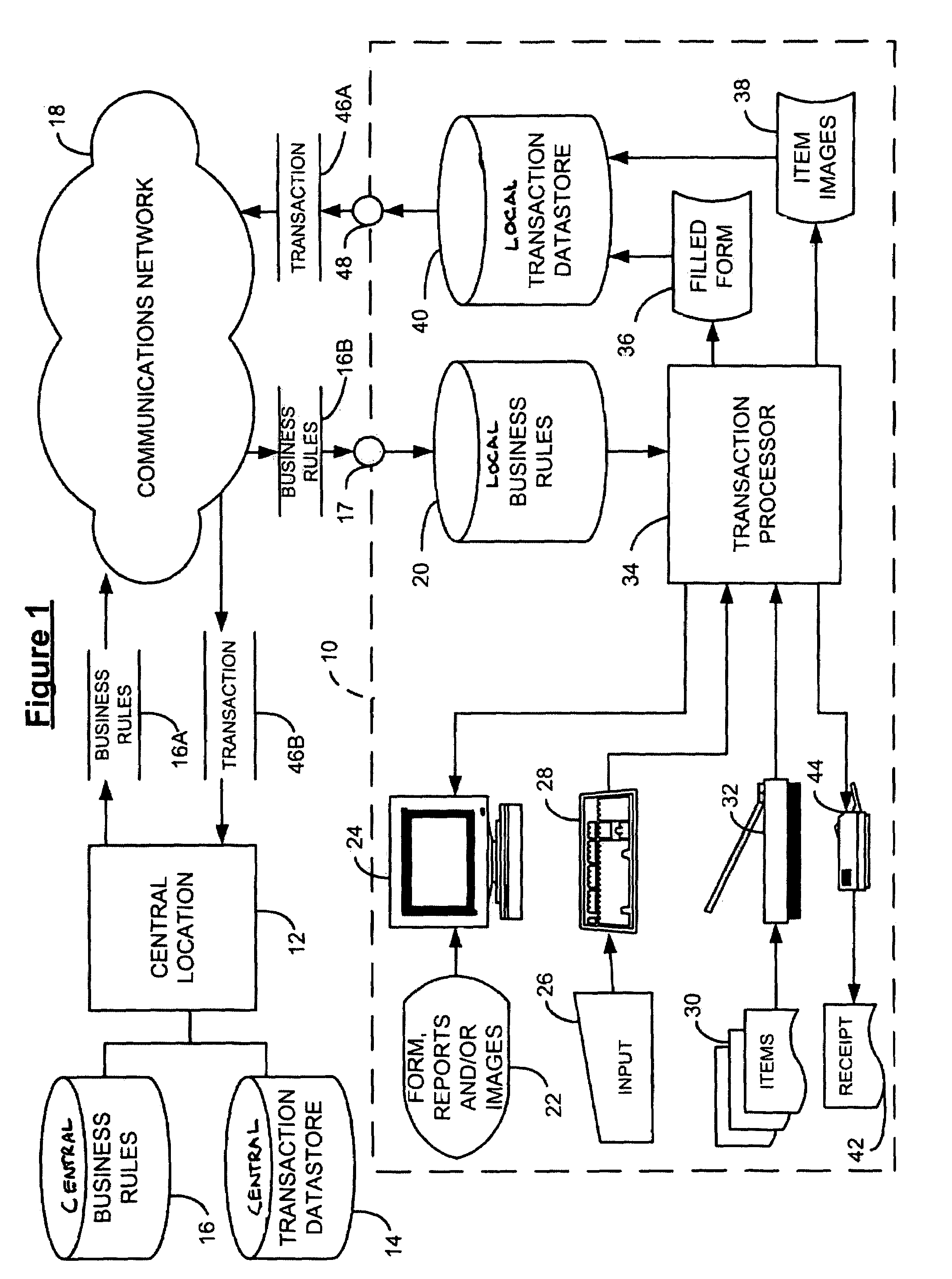

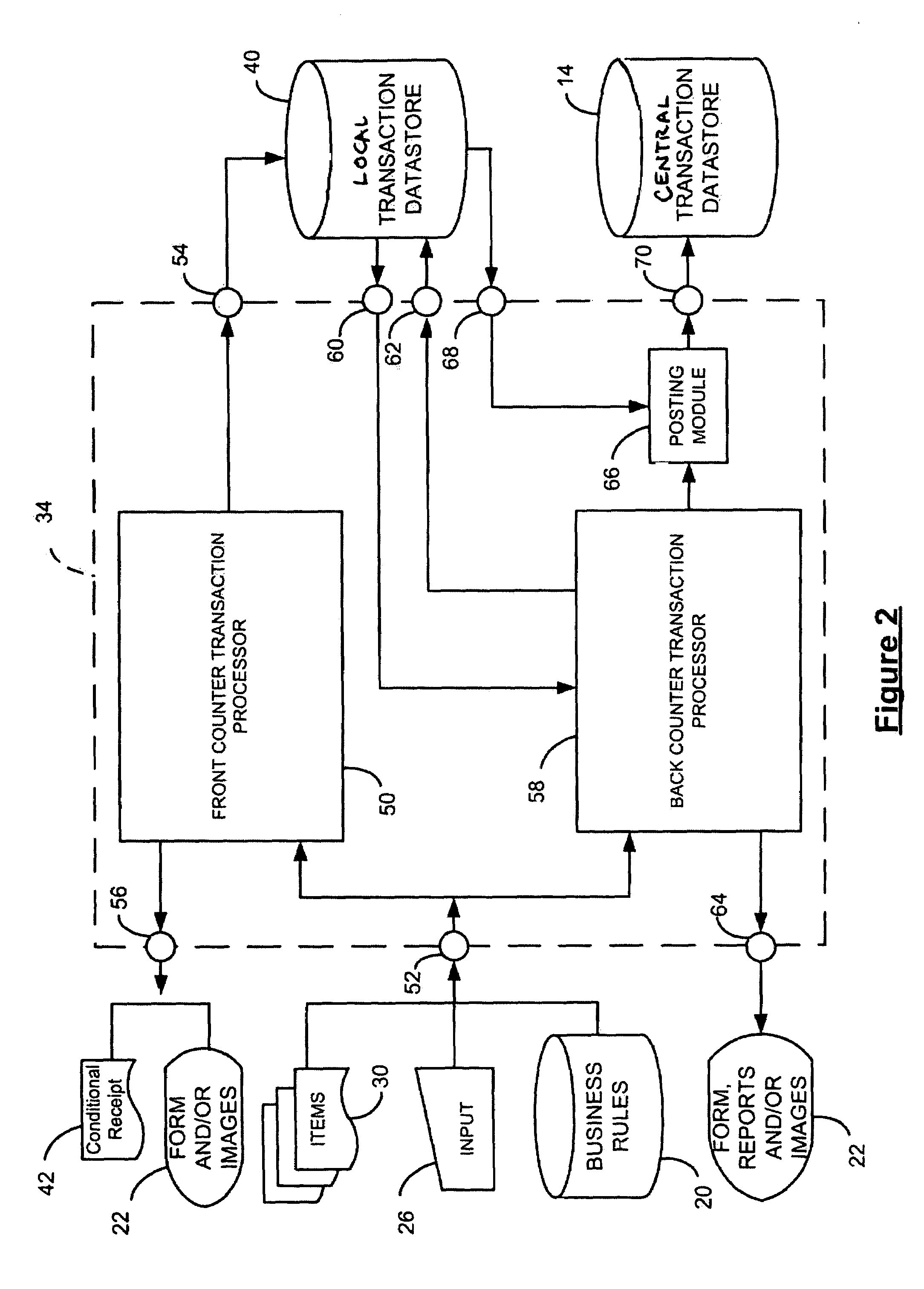

Front counter and back counter workflow integration

A system and method for processing financial transactions includes an input receptive of cash and a plurality of images of physical items of the transaction, wherein the images contain a visual record of the transaction data such as an amount of monetary value. A front, counter transaction processor processes the cash and a first item image and generates front counter transaction data. A back counter transaction processor processes item images of the transaction and generates back counter transaction data. A match module matches back counter transaction data to front counter transaction data. An output is adapted to transmit front counter transaction data and back counter transaction data to at least one of form fields and a temporary transaction datastore.

Owner:ALOGENT CORP

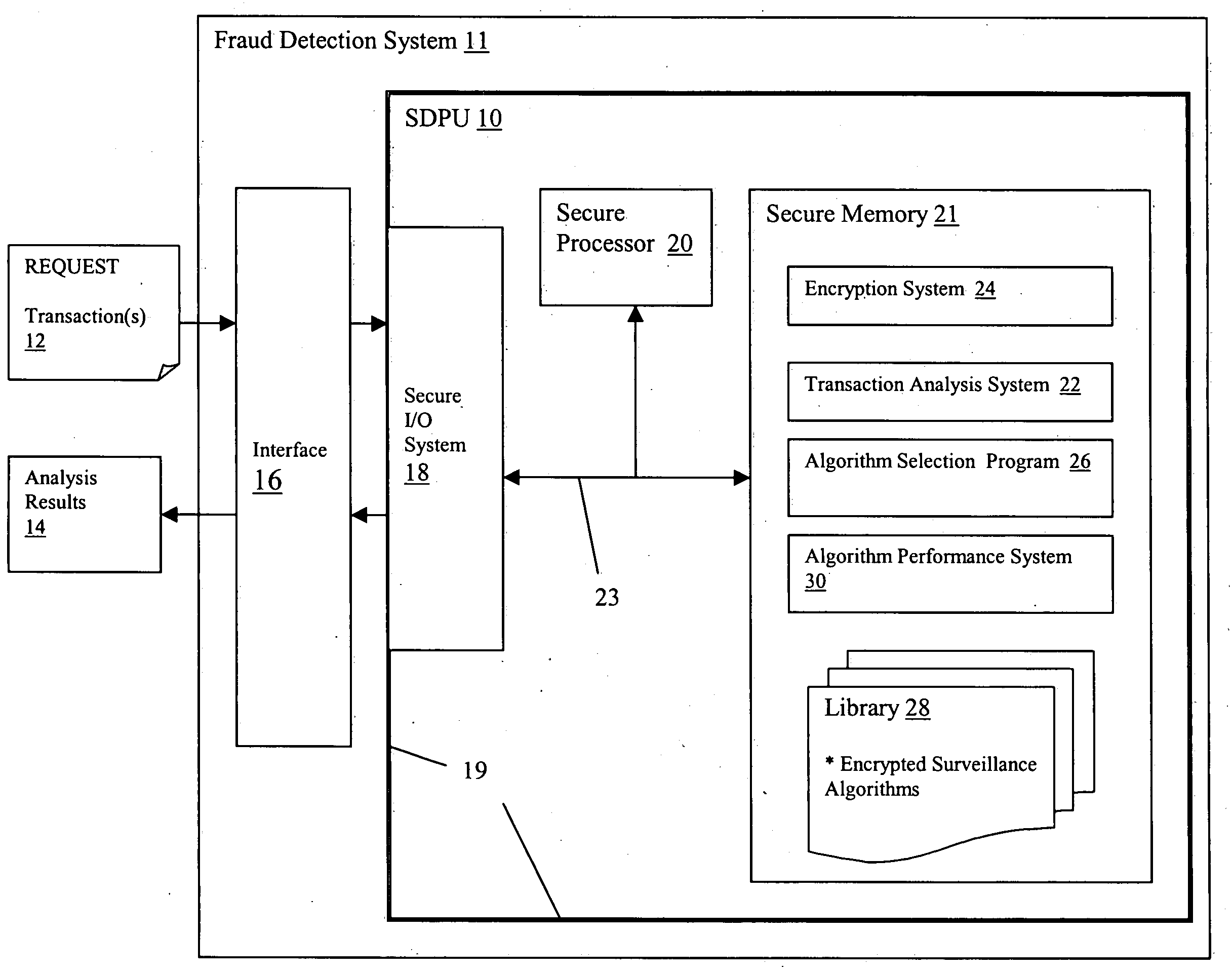

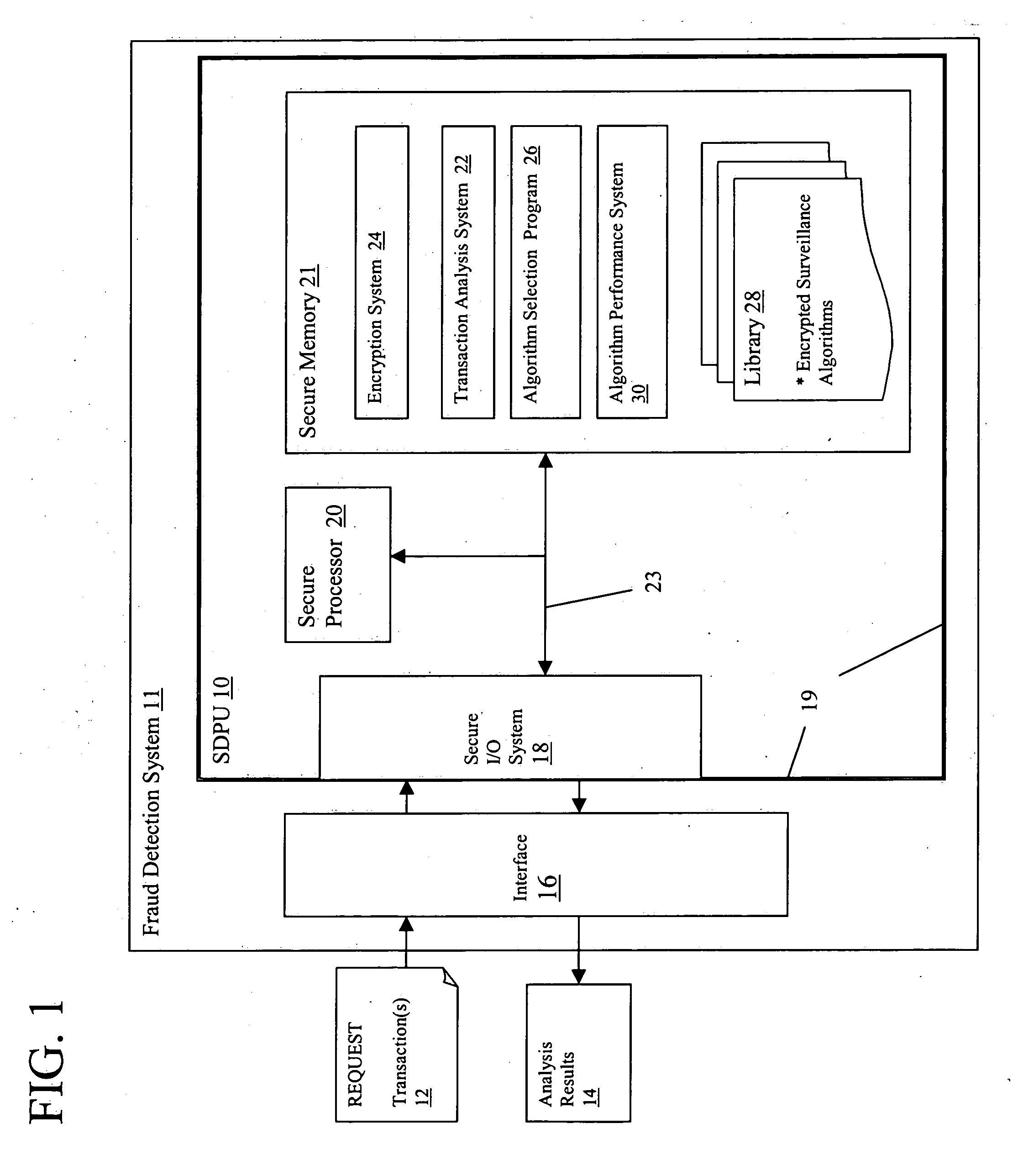

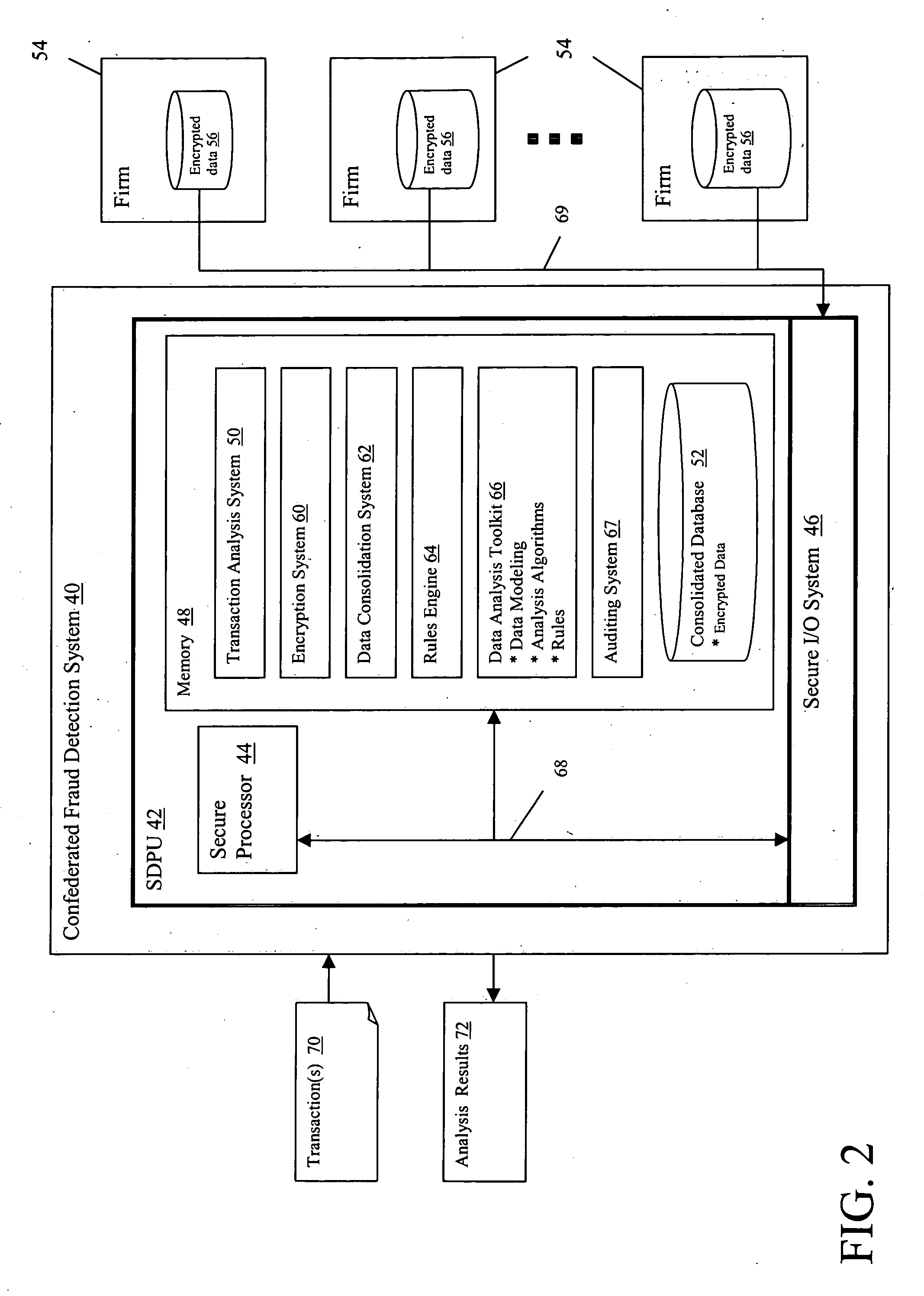

Confidential fraud detection system and method

ActiveUS20050091524A1Easy to detectDigital data processing detailsCryptography processingInternet privacyConfidentiality

Various embodiments for maintaining security and confidentiality of data and operations within a fraud detection system. Each of these embodiments utilizes a secure architecture in which: (1) access to data is limited to only approved or authorized entities; (2) confidential details in received data can be readily identified and concealed; and (3) confidential details that have become non-confidential can be identified and exposed.

Owner:IBM CORP

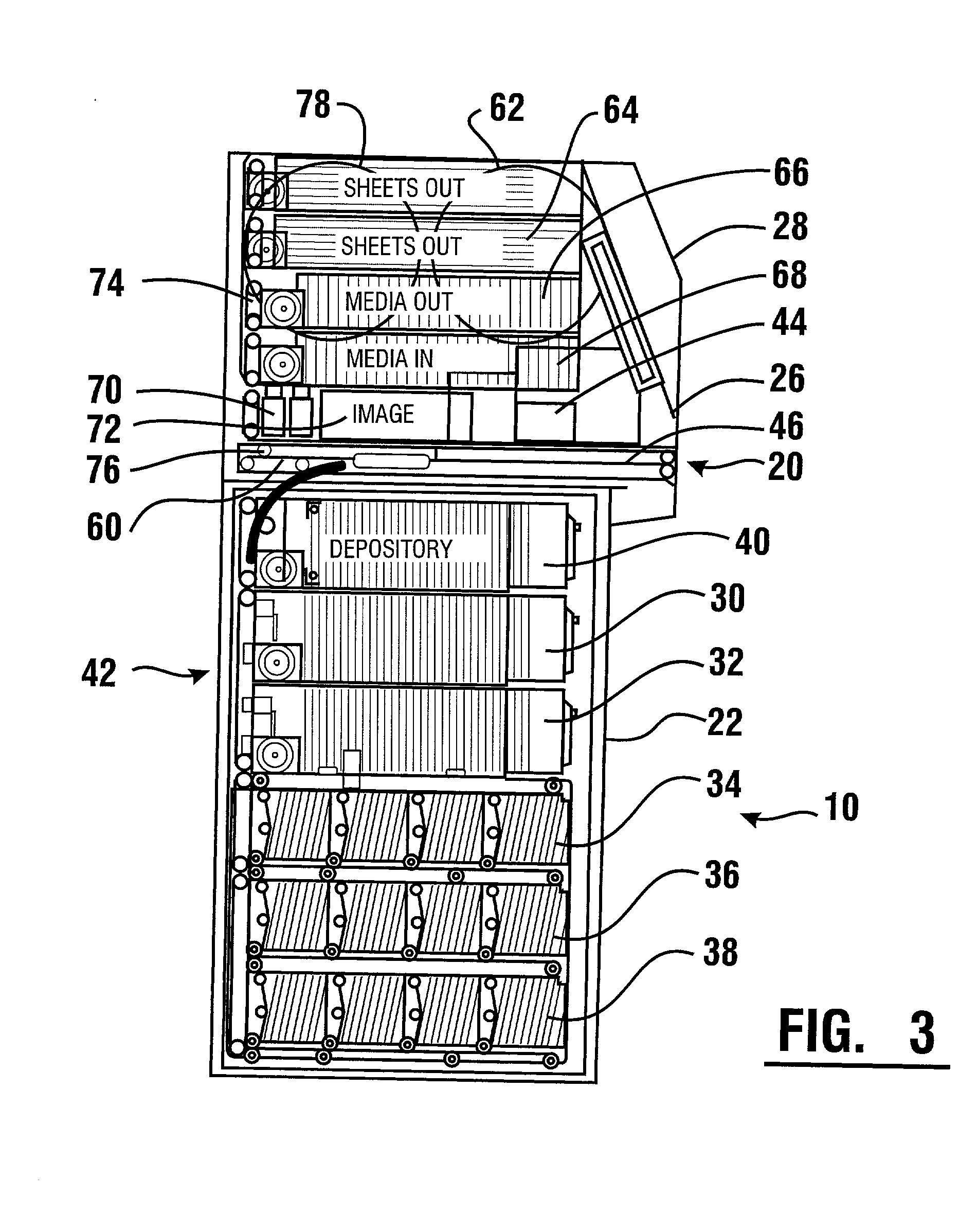

Automated banking machine currency tracking method

ActiveUS20030116478A1Simpler customer interfaceOptimizationComplete banking machinesFinanceChequeEngineering

An automated banking machine (10) includes a user interface (12) including an opening (20). Users of the machine deliver and receive individual sheets and stacks of sheets to and from the machine through the opening. Stacks of sheets may include sheets such as notes, checks or other documents. Stacks input to the machine may include mixtures of various types of sheets. The machine operates to receive notes, process checks and perform other operations. Notes received in the machine and assessed as valid may be recycled and dispensed to other users. Notes assessed by the machine as being of questionable validity may be marked with a removable mark and subjected to further analysis. Checks processed by the machine may be imaged by an imaging device, cancelled and stored in the machine or alternatively returned to a user. Documents produced by the machine such as receipts, checks or money orders as well as notes dispensed from the machine may be assembled into a stack within the machine and delivered from the machine through the opening.

Owner:DIEBOLD NIXDORF

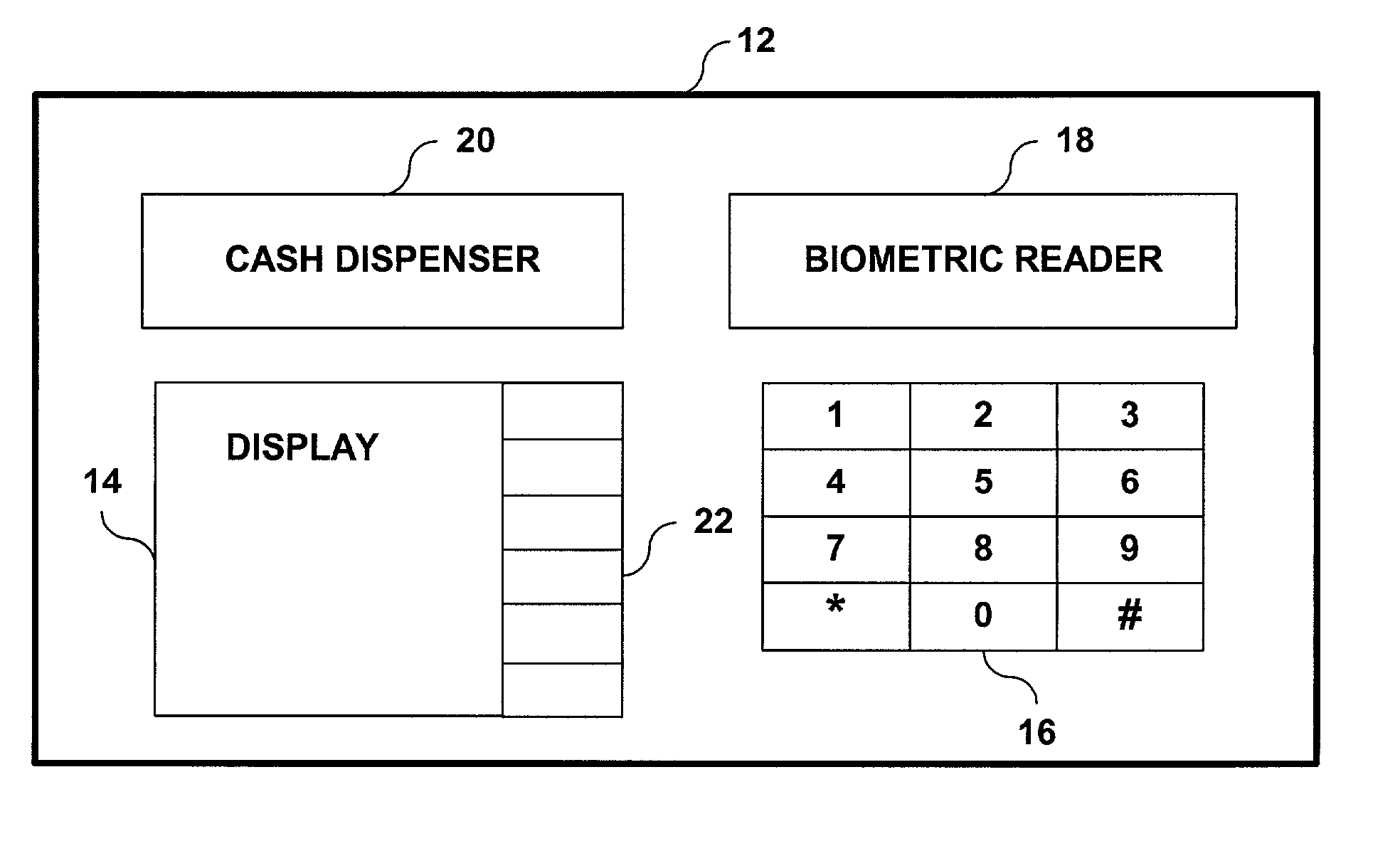

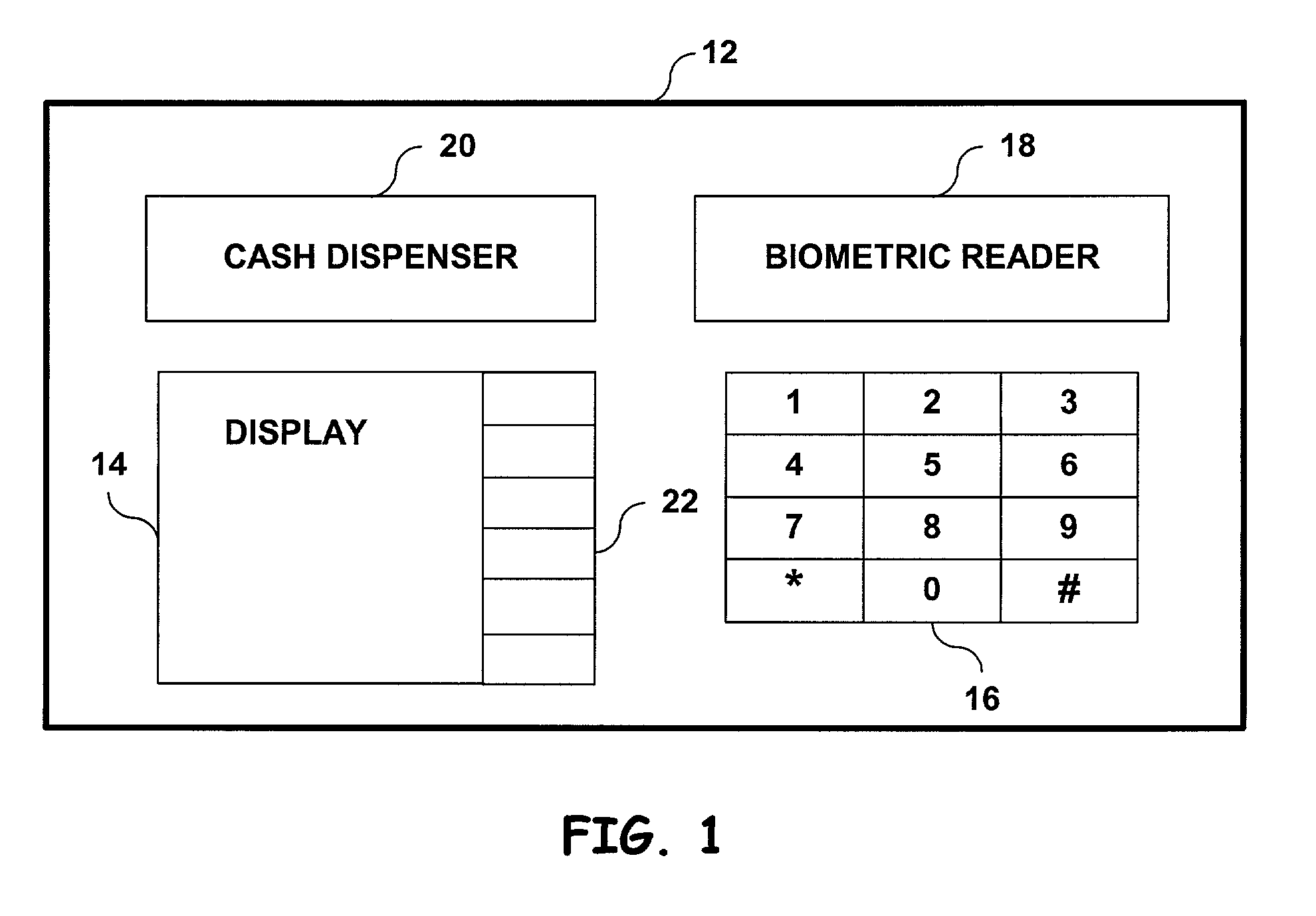

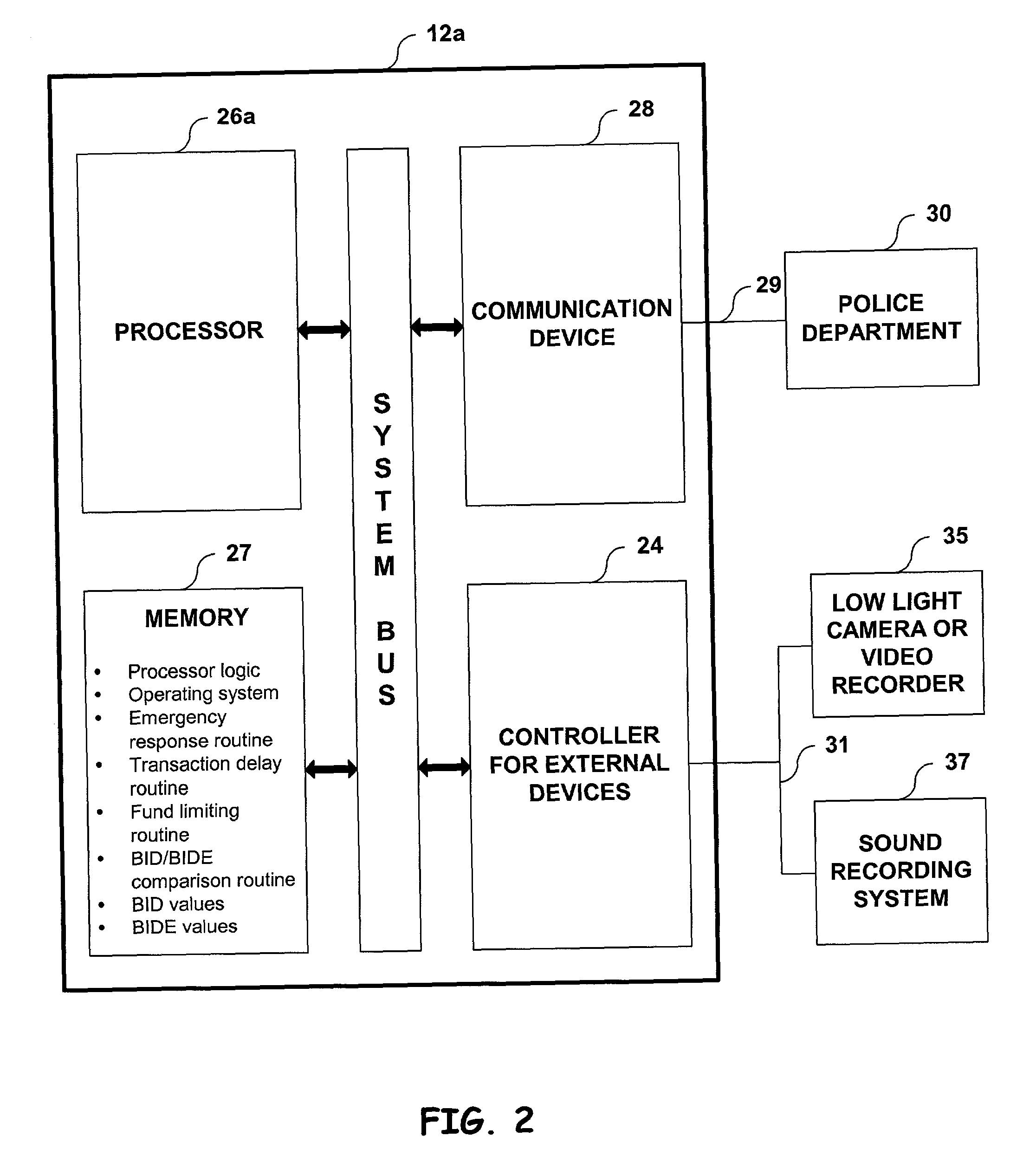

Biometric system and method for detecting duress transactions

InactiveUS20020038818A1Complete banking machinesCharacter and pattern recognitionBiometric systemBiometric trait

A system for responding to a duress identification made at a biometric identification site. The system may include a processor, a memory, a biometric reader for collecting biometric information about a user, wherein the biometric information is used for determining if the user is an authorized user of the system. The system may also include a set of instructions stored in the memory, the set of instructions executable by the processor to determine whether the biometric information represents a normal identification or a duress identification; if the biometric information represents a duress identification, the system may initiate an emergency response, such as (for example) triggering a silent alarm.

Owner:ZINGHER JOSEPH P +1

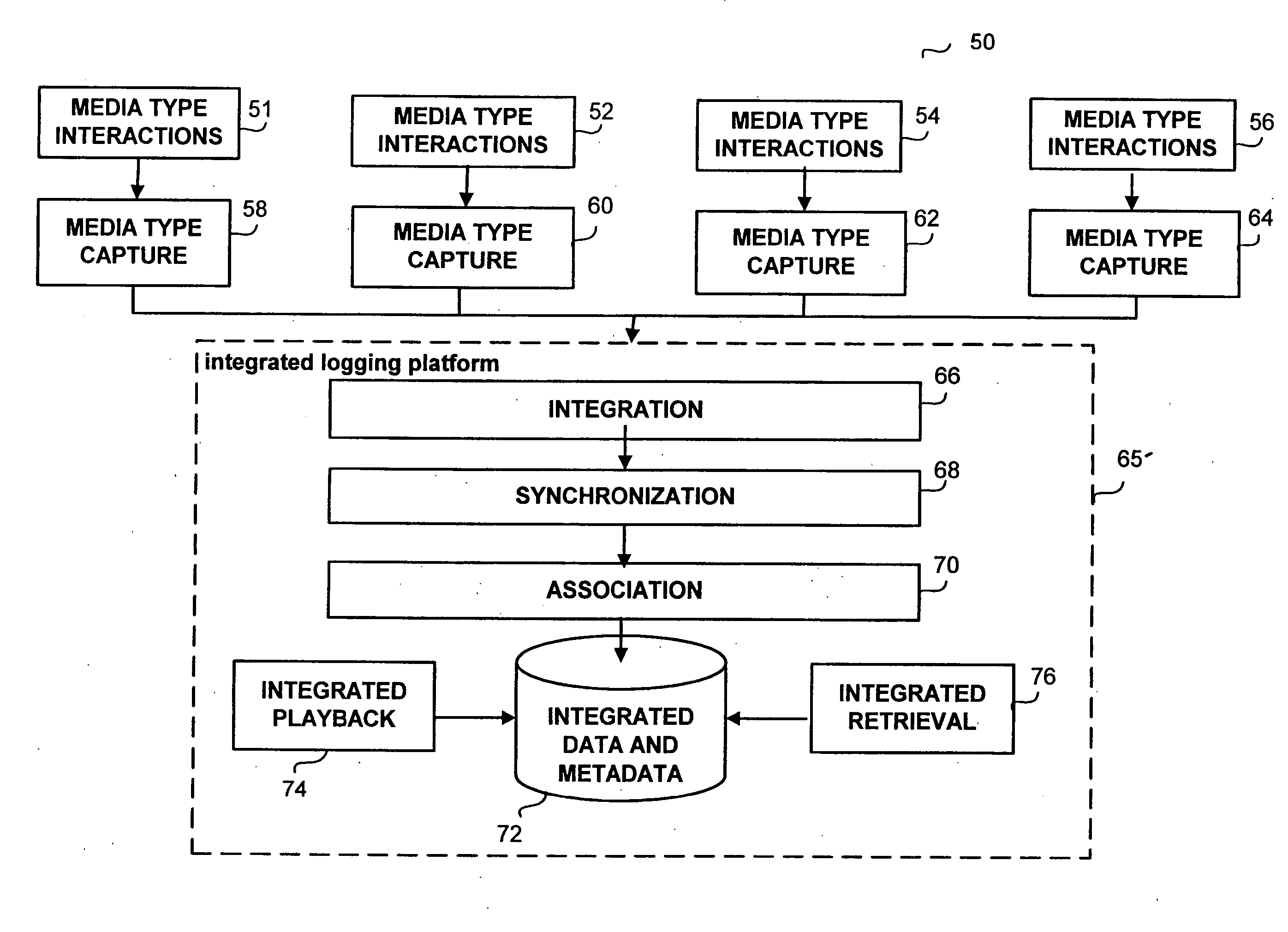

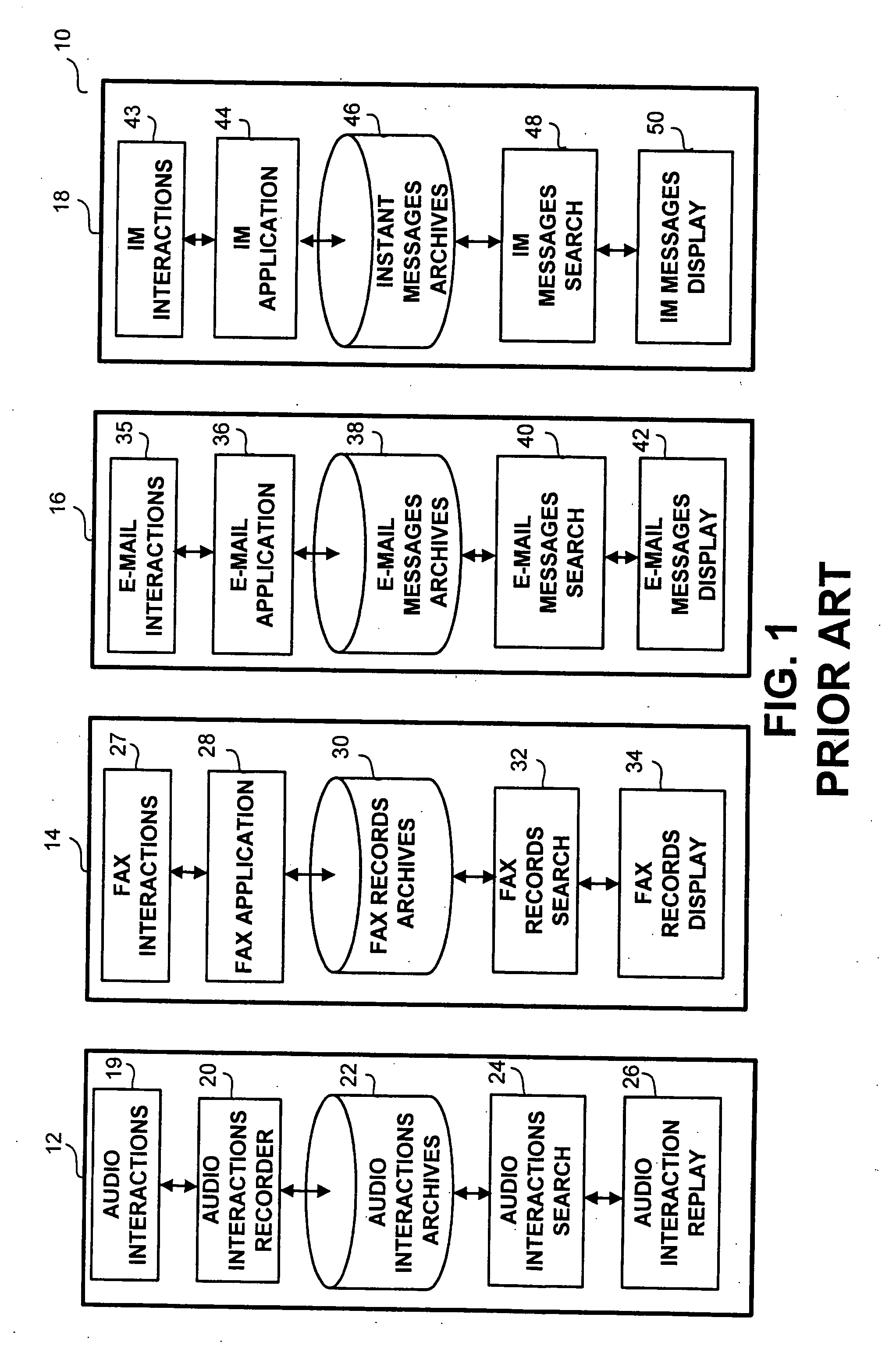

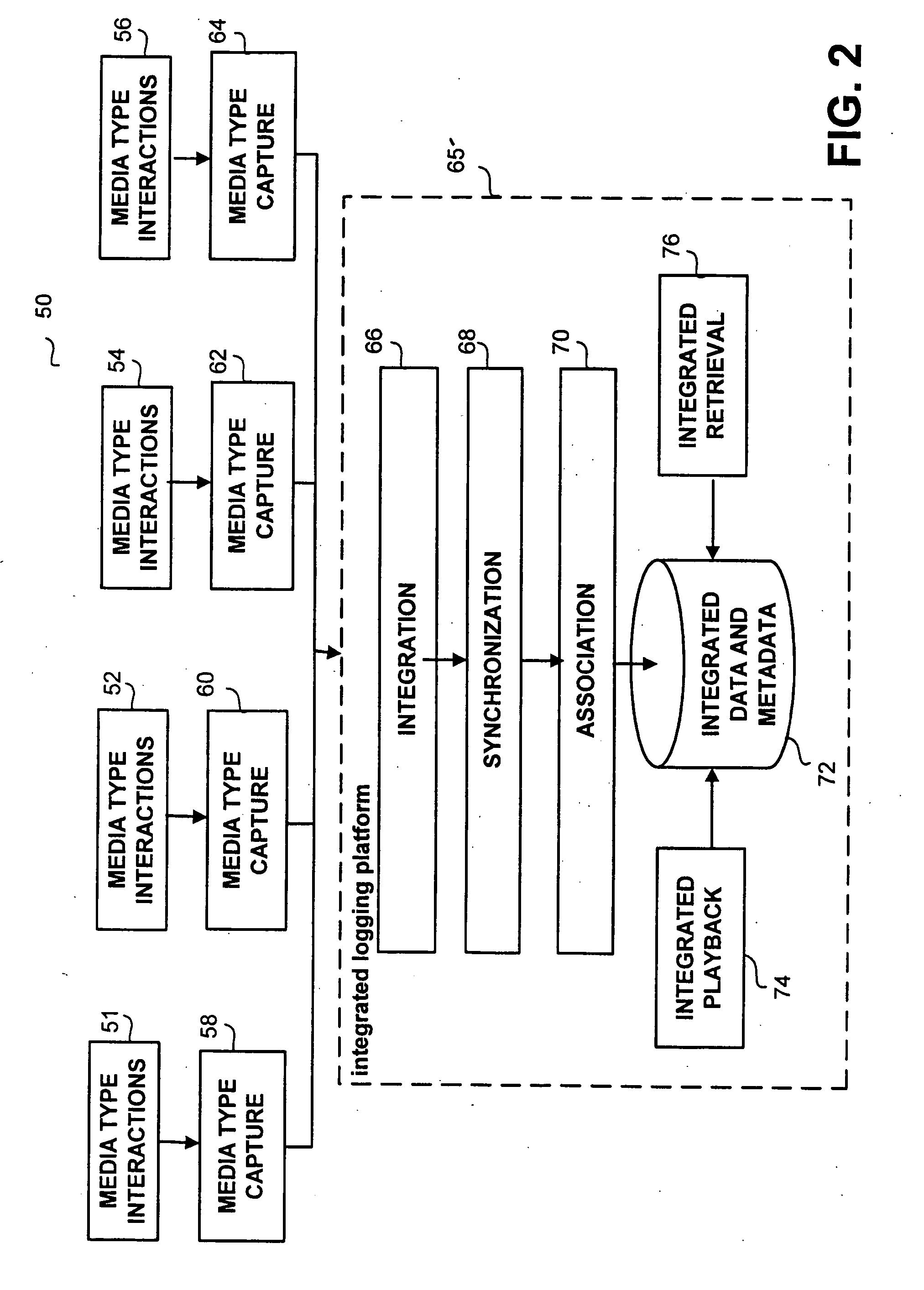

Apparatus, system and method for dispute resolution, regulation compliance and quality management in financial institutions

An apparatus, system and method for multimedia capturing, logging and retrieval are disclosed. The apparatus provides time synchronized voice and data interactions capturing and logging, secured playback and retrieval functionality for dispute resolution, for detecting negative and positive conduct, for business analysis and performance, and for quality management. The apparatus provides for synchronization and association of multi-media interactions for financial transactions in order to provide for the retrieval, playback, and review of the transaction-specific events in their temporally correct and integrated sequence.

Owner:NICE LTD

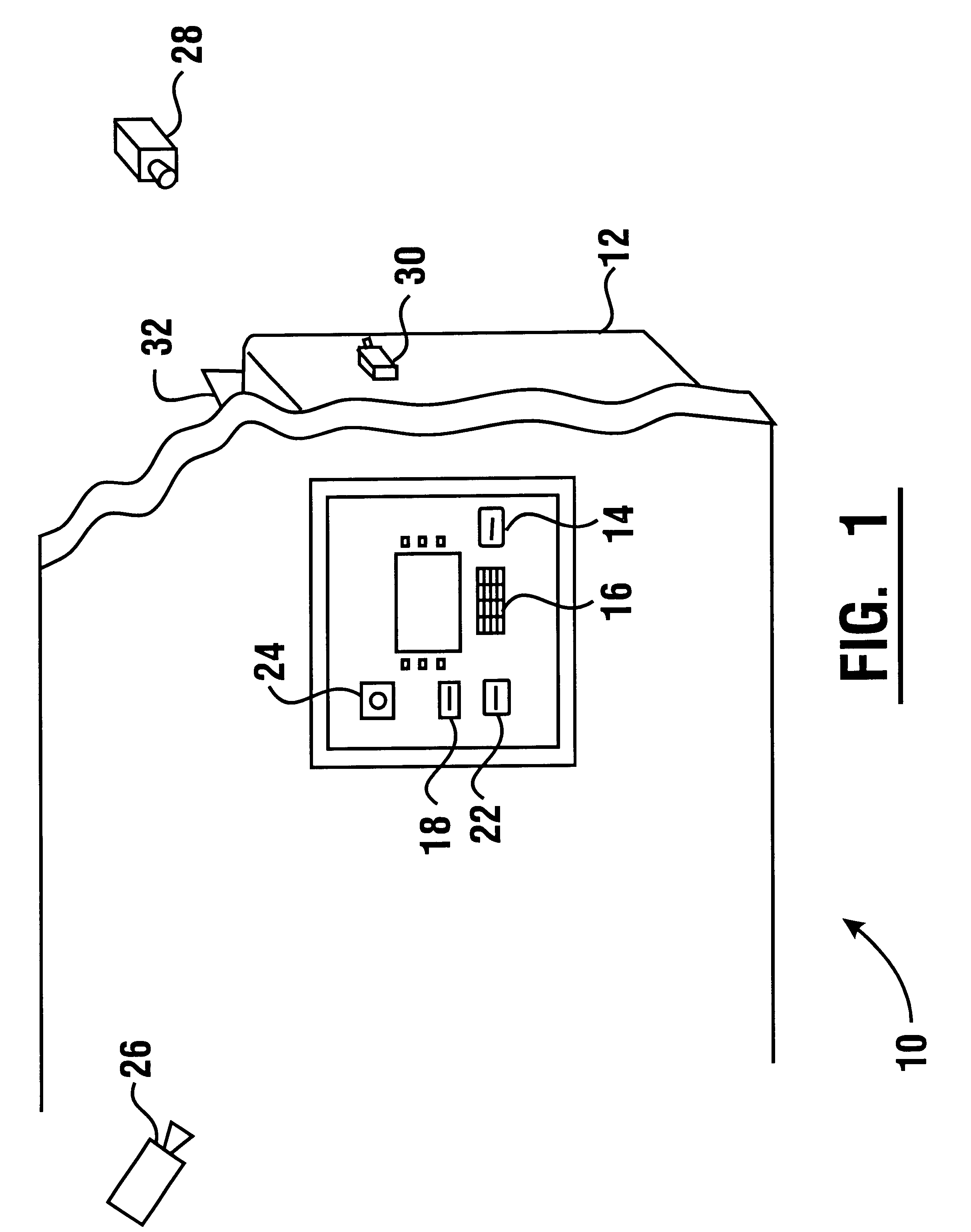

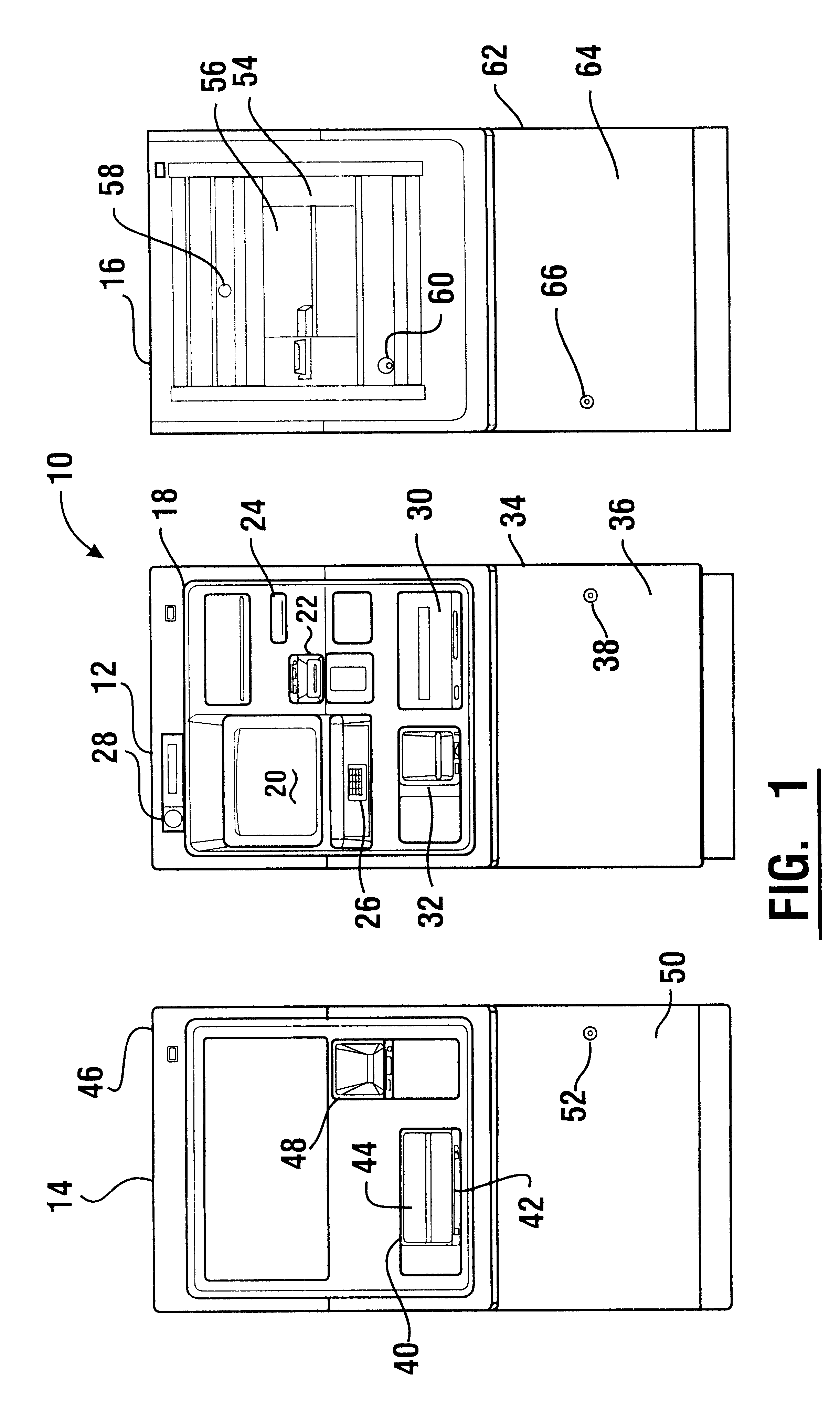

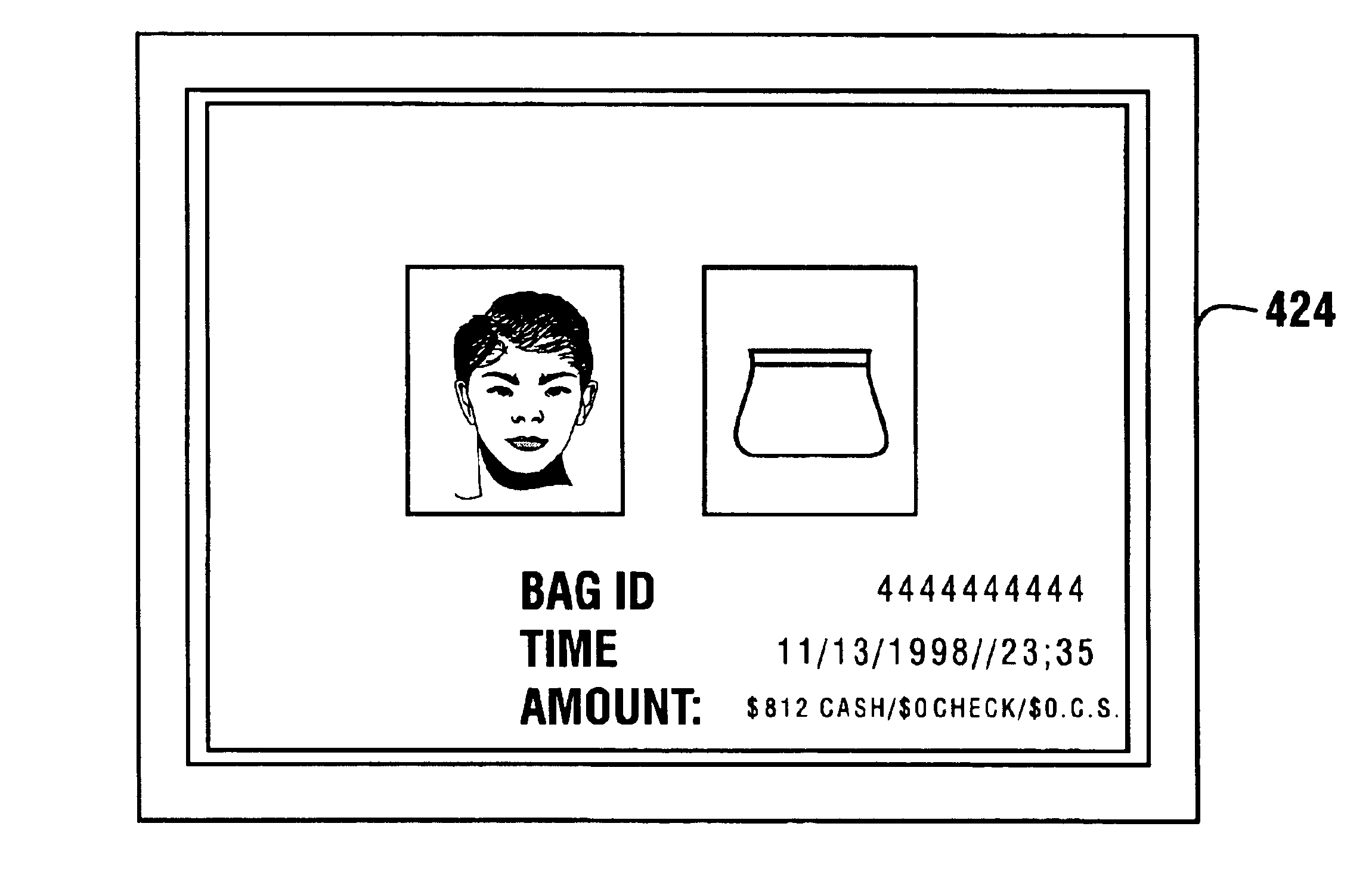

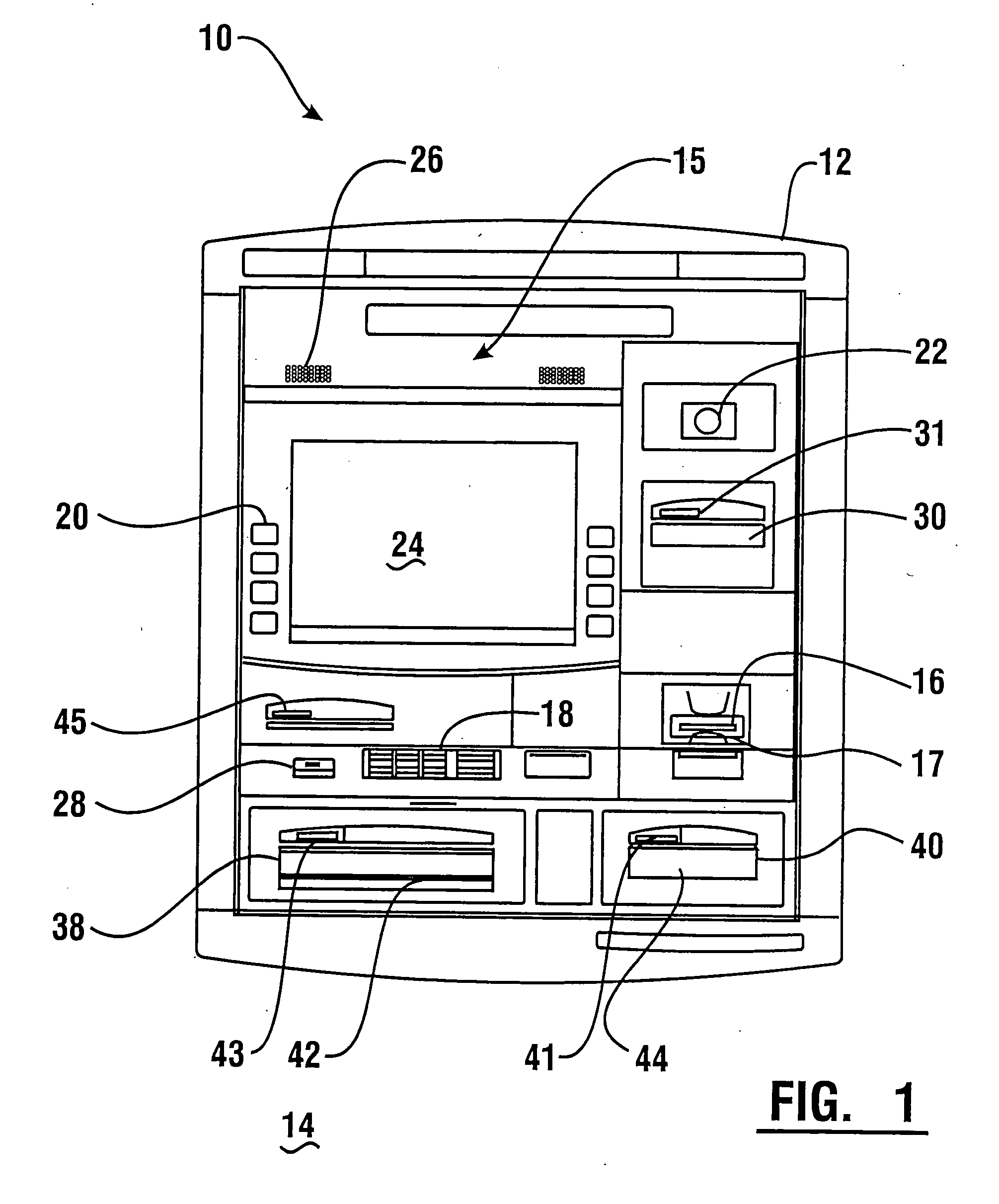

Automated merchant banking apparatus and method

InactiveUS6761308B1Good user interfaceAccurate specificationsComplete banking machinesFinanceUser inputDisplay device

An automated merchant banking apparatus (10) which is operative to carry out banking transactions commonly required by merchants. The apparatus includes a user interface (18) which includes a plurality of input and output devices. The apparatus further includes an item accepting depository (54) for accepting deposit items containing currency, instruments or other items of value. The apparatus includes cameras (58,326) for capturing images of a user and deposit items input by the user. The user and item inputs are stored in associated relation in a storage device. The images of the user and the deposit item are also output to the user simultaneously through a display (424) to assure the user that a record of the deposit transaction has been made.

Owner:DIEBOLD NIXDORF

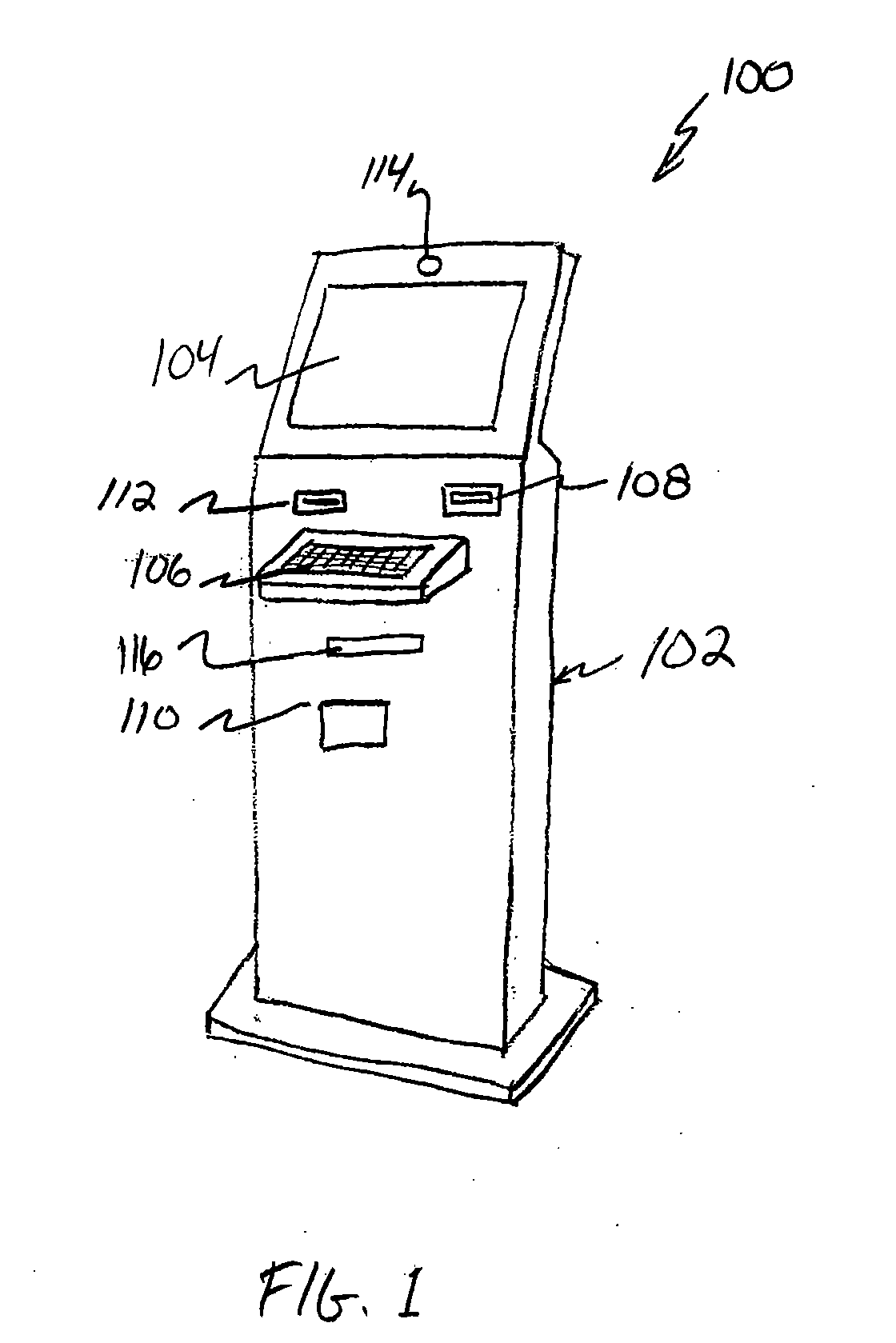

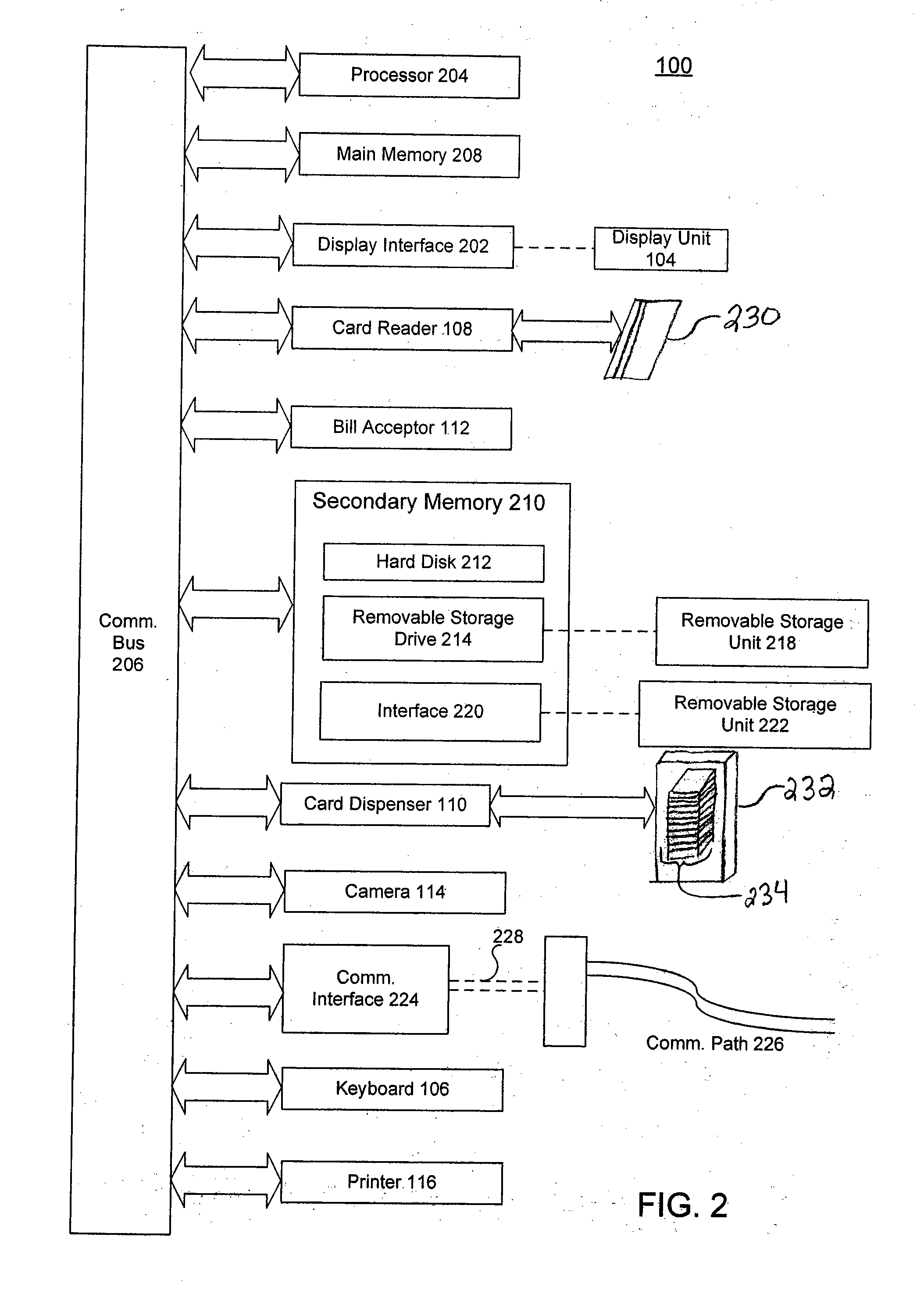

Kiosk and Method for Vending Stored Value Cards

InactiveUS20070272743A1Positive experienceShorten transaction timeComplete banking machinesApparatus for meter-controlled dispensingCredit cardInput selection

A kiosk machine vends stored value cards (i.e., pre-paid and gift cards). The kiosk is self-service and will allow a user to select, purchase and pay for a stored value card without requiring the presence or assistance of a sales clerk. The kiosk can vend one or more cards in a single transaction. The kiosk is a computer-based vending machine having a touch-sensitive video screen and a card reader. The touch screen provides a user interface for a user to receive information and provide input selections. The card reader can be used to read a transaction card (e.g., an American Express card or credit card) to facilitate payment for the stored value card(s) being purchased. The vending method comprises: providing a kiosk having a user interface; receiving, via the user interface, a request to purchase a stored value card, receiving payment for the purchase; determining a card number associated with a selected card; activating the selected card to produce an activated stored value card in the card denomination; and dispensing the activated stored value card. A user purchasing a stored value card can select a type of stored value card, wherein the type is selected from the group consisting of an open card and a closed card. The closed card can be of the type usable only in a shopping center where the kiosk is physically located. The user can further select a card denomination. The method further allows a user to check a card balance for a stored value card.

Owner:LIBERTY PEAK VENTURES LLC

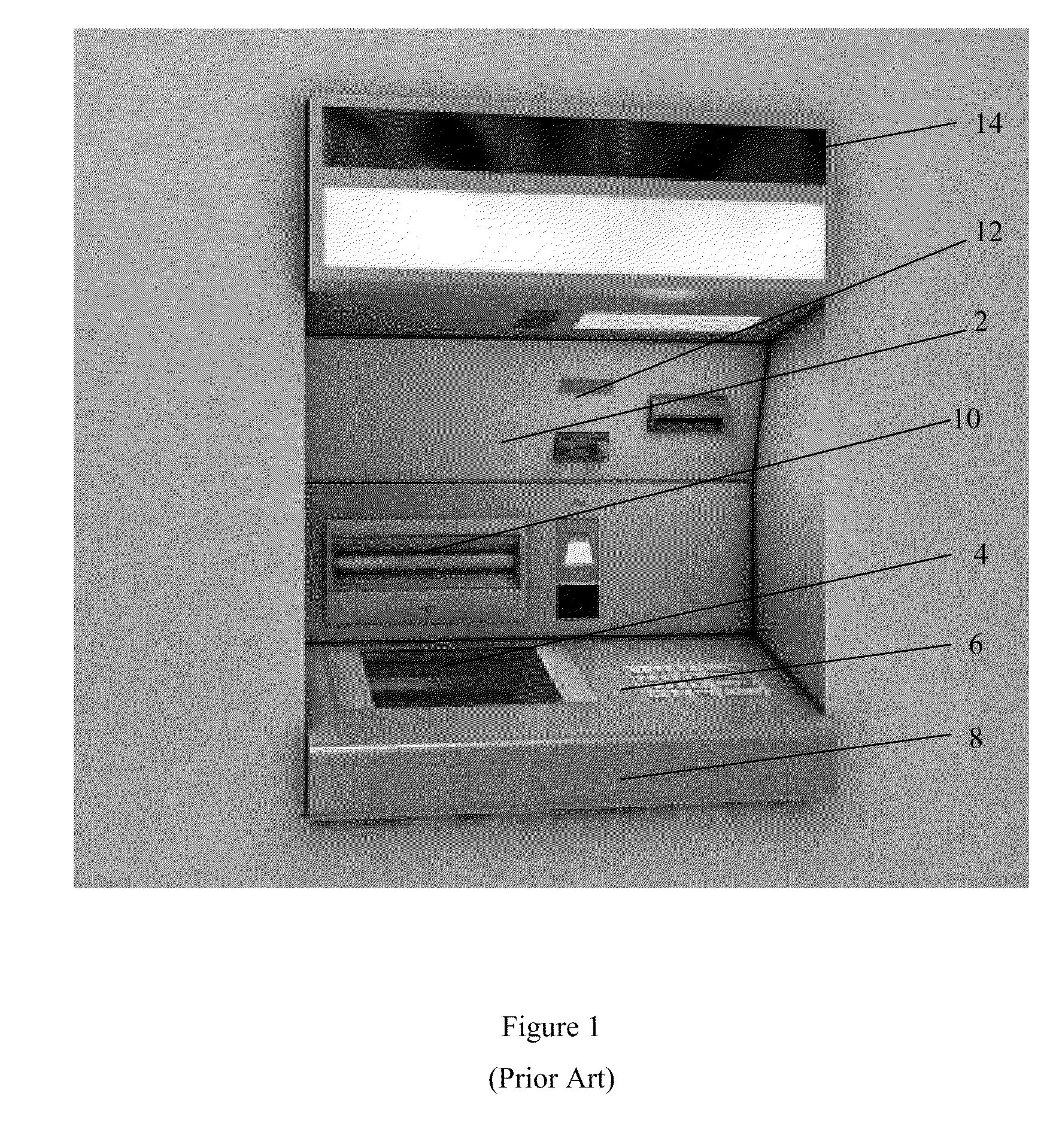

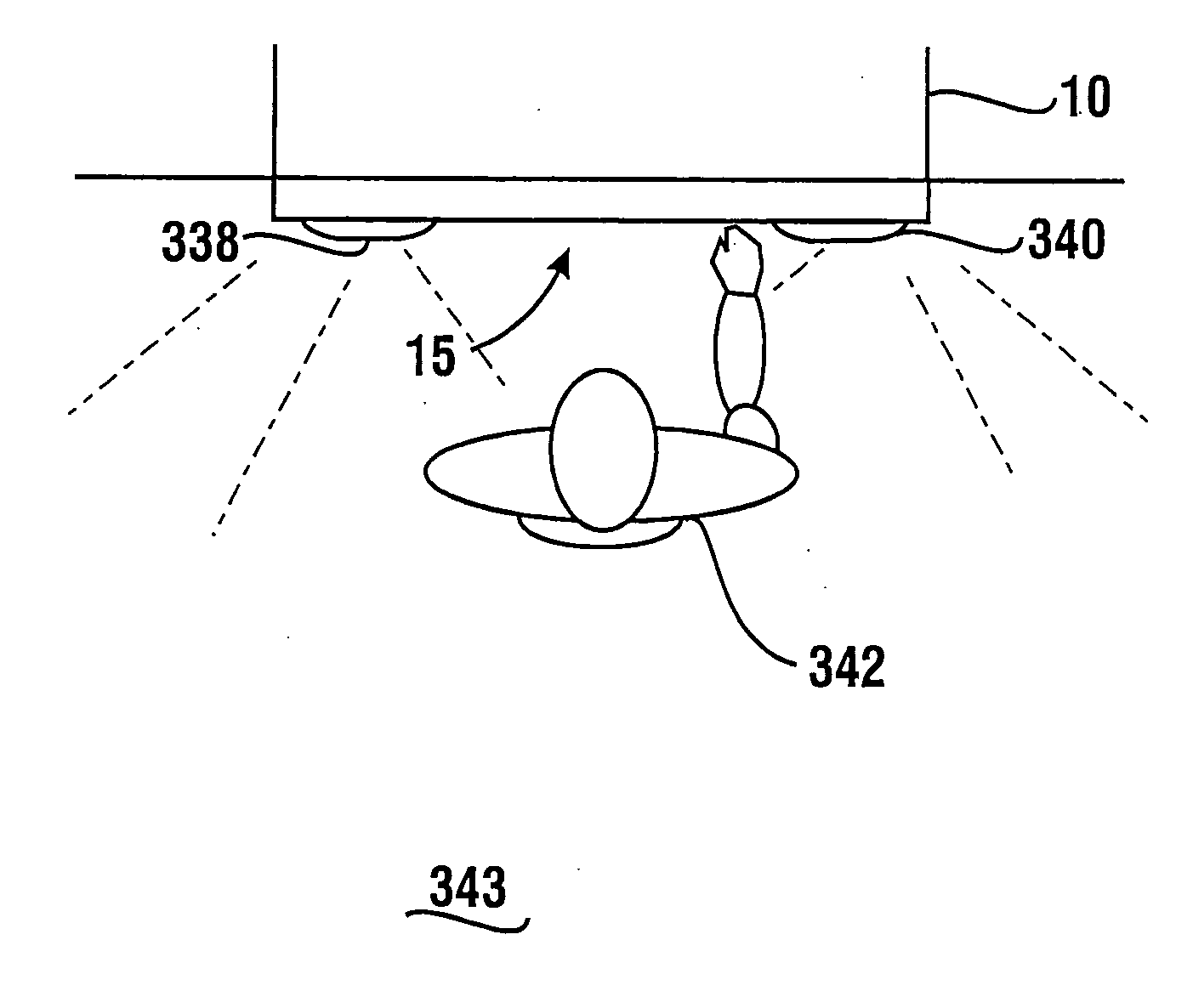

Cash dispensing automated banking machine with improved user observation capabilities

InactiveUS20040129773A1Reduce riskFacilitate gaining accessComplete banking machinesFinanceComputer hardwareUser interface

An automated banking machine (10) includes a user interface (15) and a cash dispensing mechanism (220). A fascia of the machine (12) includes a pair of horizontally disposed convex mirrors (338, 340) which enables viewing an area (343) behind the user of the machine. Sensors are operative to determine when a mirror requires cleaning and to cause the mirror to be cleaned either by actuating a cleaning device and / or by contacting a remote servicer. Lights may be selectively directed and illuminated to reduce the risk of observation of inputs to the machine by unauthorized persons.

Owner:DIEBOLD NIXDORF

Data security system

InactiveUS20060005042A1Easy accessNeed can be addressedDigital data processing detailsChecking apparatusData accessComputer usage

A data security system comprises a host processor, and a plurality of remote computers. Each remote computer provides biometric authentication of a user prior to responding to the user request for data access. The remote computers are handheld when in operational mode. A sensor in the handheld computer captures a biometric image while the remote computer is being used. The biometric sensor is positioned in such a way that the sensor enables the capture of the biometric image continually during computer usage with each request for access to secure data. The biometric authentication occurs in a seamless manner and is incidental to the data request enabling user identity authentication with each request to access secure data.

Owner:UNITED STATES CP LLC

Cash dispensing automated banking machine diagnostic device

InactiveUS6953150B2Expand accessHigh outputComplete banking machinesFinanceDiagnostic dataMachine diagnostics

An automated banking machine (10) includes a lockable first fascia portion (20) which when unlocked enables access to a chest lock input device (104), inputs to which enable opening a chest door (18) of the machine. Opening the first fascia portion also enables access to an actuator (116) which enables moving a second fascia portion (22) for conducting service activities. A controller (72) in the machine selectively illuminates light emitting devices (118, 126) for purposes of facilitating user operation of the machine. Sensing devices (128) adjacent a card reader slot (28) on the machine enables the controller to detect the presence of unauthorized card reading devices. Servicing the machine is facilitated through use of a portable diagnostic article (98) which enables the controller to access diagnostic data stored in memory and which provides data indicative of the significance of the diagnostic data.

Owner:DIEBOLD SELF SERVICE SYST DIV OF DIEBOLD NIXDORF INC

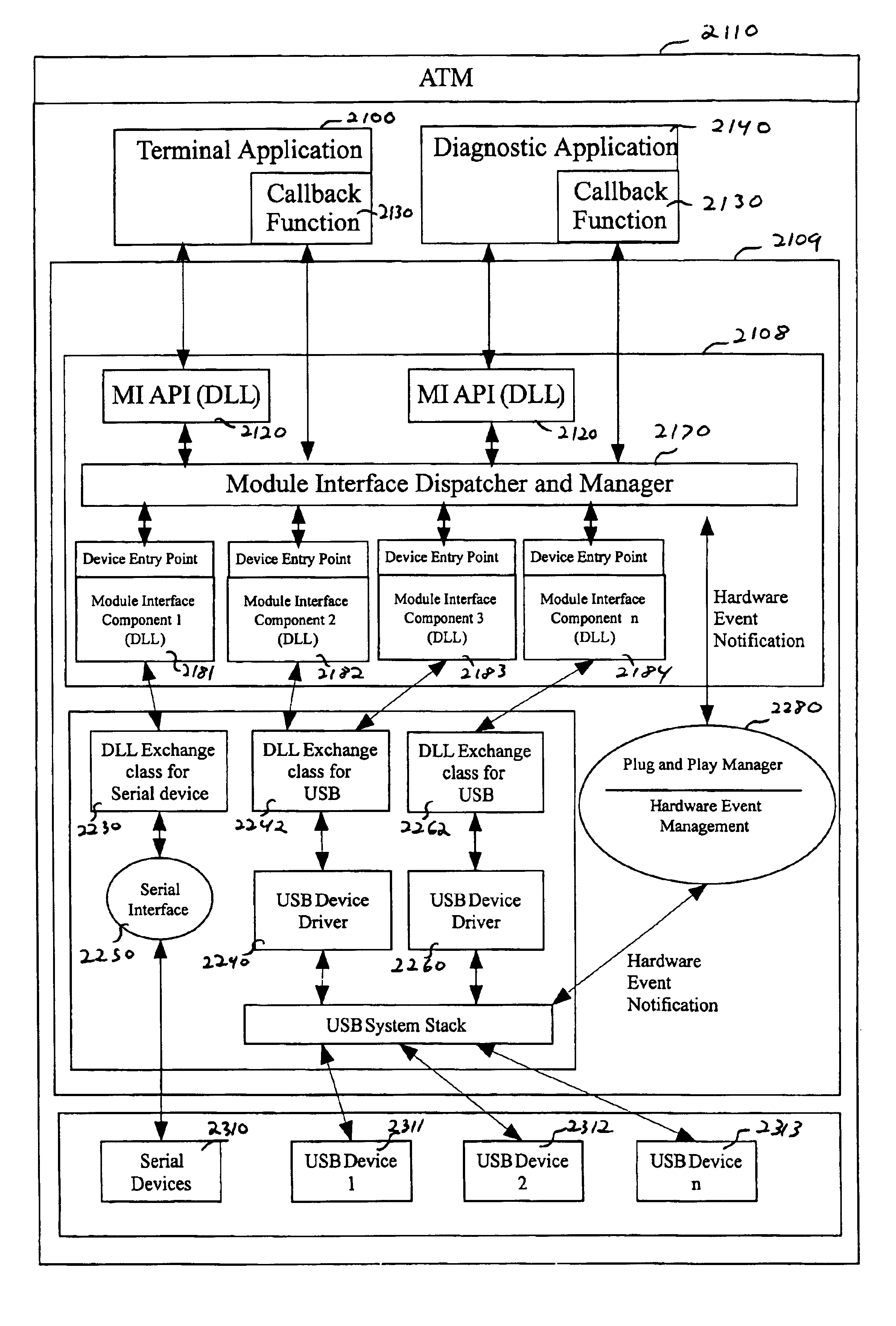

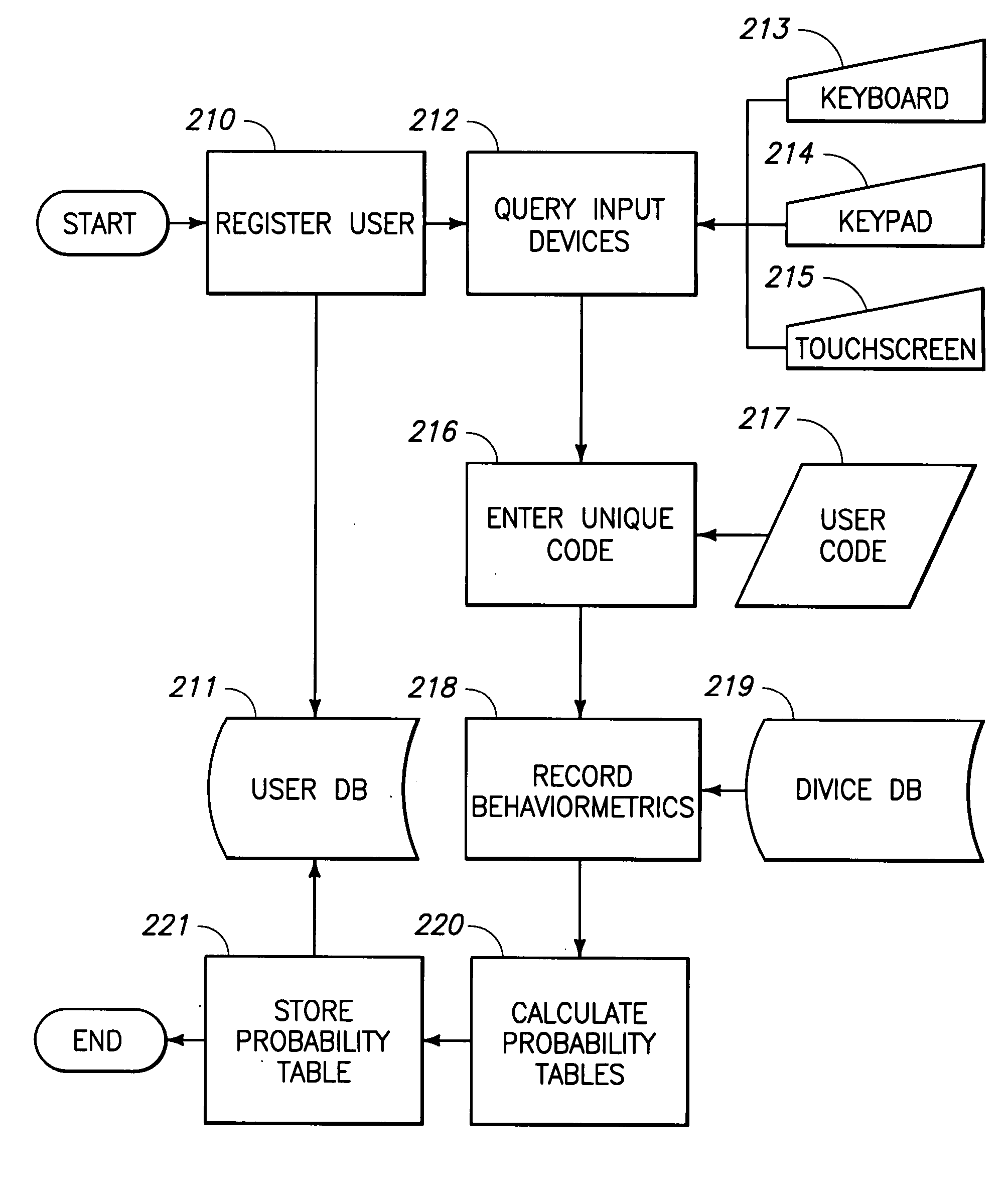

Behaviormetrics application system for electronic transaction authorization

InactiveUS20080091453A1Adaptable to changeFast and adaptable and scalable mechanismAcutation objectsDigital data processing detailsPasswordDynamic data

This invention discloses a system wherein behaviormetrics are utilized to authenticate electronic transactions, either alone or in combination with other identifiers such as PIN's, passwords, codes and the like. Probability profiles or probability distribution representations may be constructed for determining whether a purported or alleged authorized user is in fact the authorized user, by comparing new data on a real-time basis against probability distribution representations including an authorized user probability distribution representation and a global or wide population probability distribution representation, to provide a probability as to whether the purported authorized user is the authorized user. This invention may utilize keypad, touch screen dynamics, X-Y dynamics, data, X-Y device data, or other data from similar measurable characteristics (such as movement filmed by an ATM machine), to determine the probability that the new data from the purported authorized user indicates or identifies that user as the authorized user.

Owner:IDENTITY METRICS

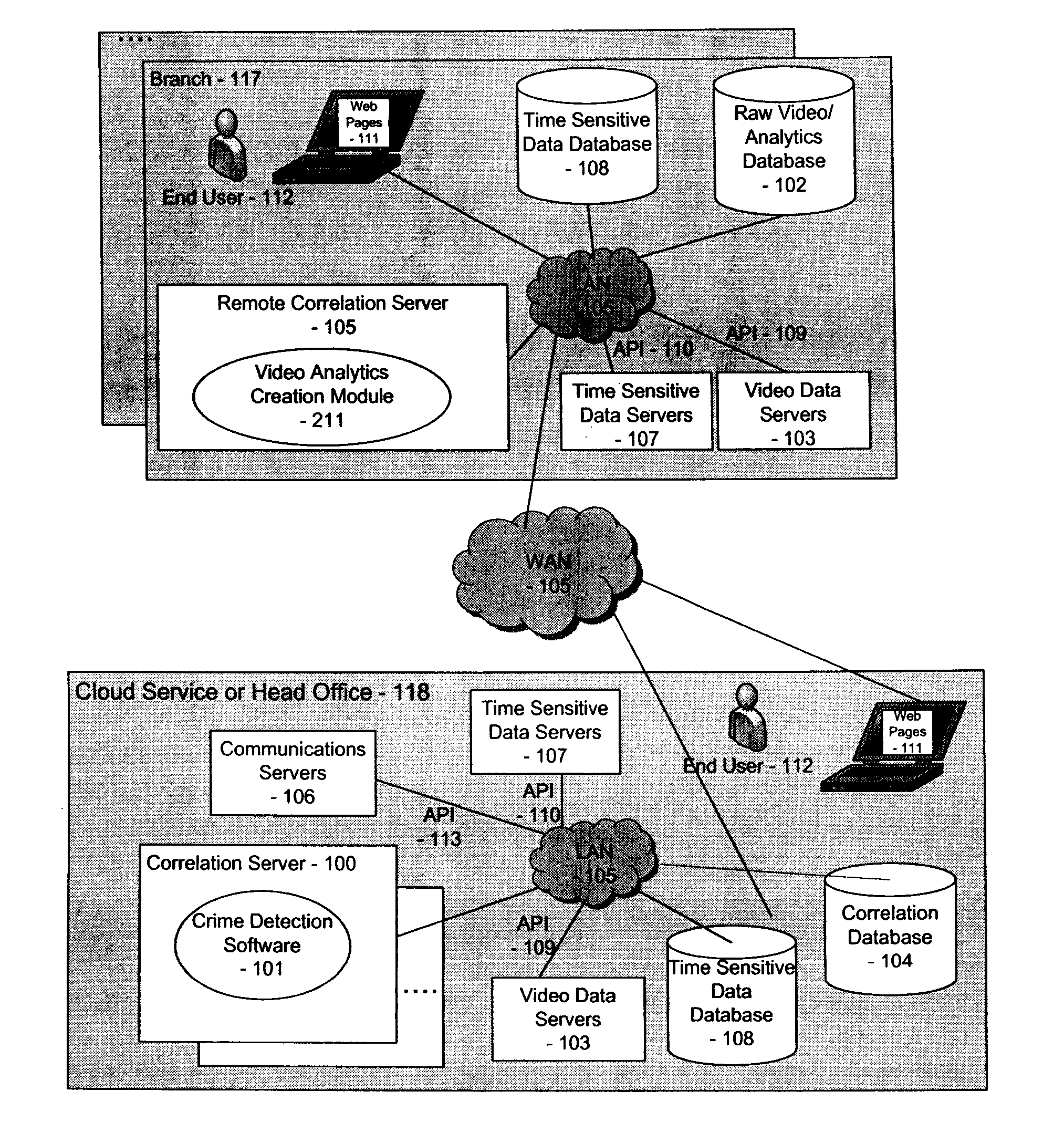

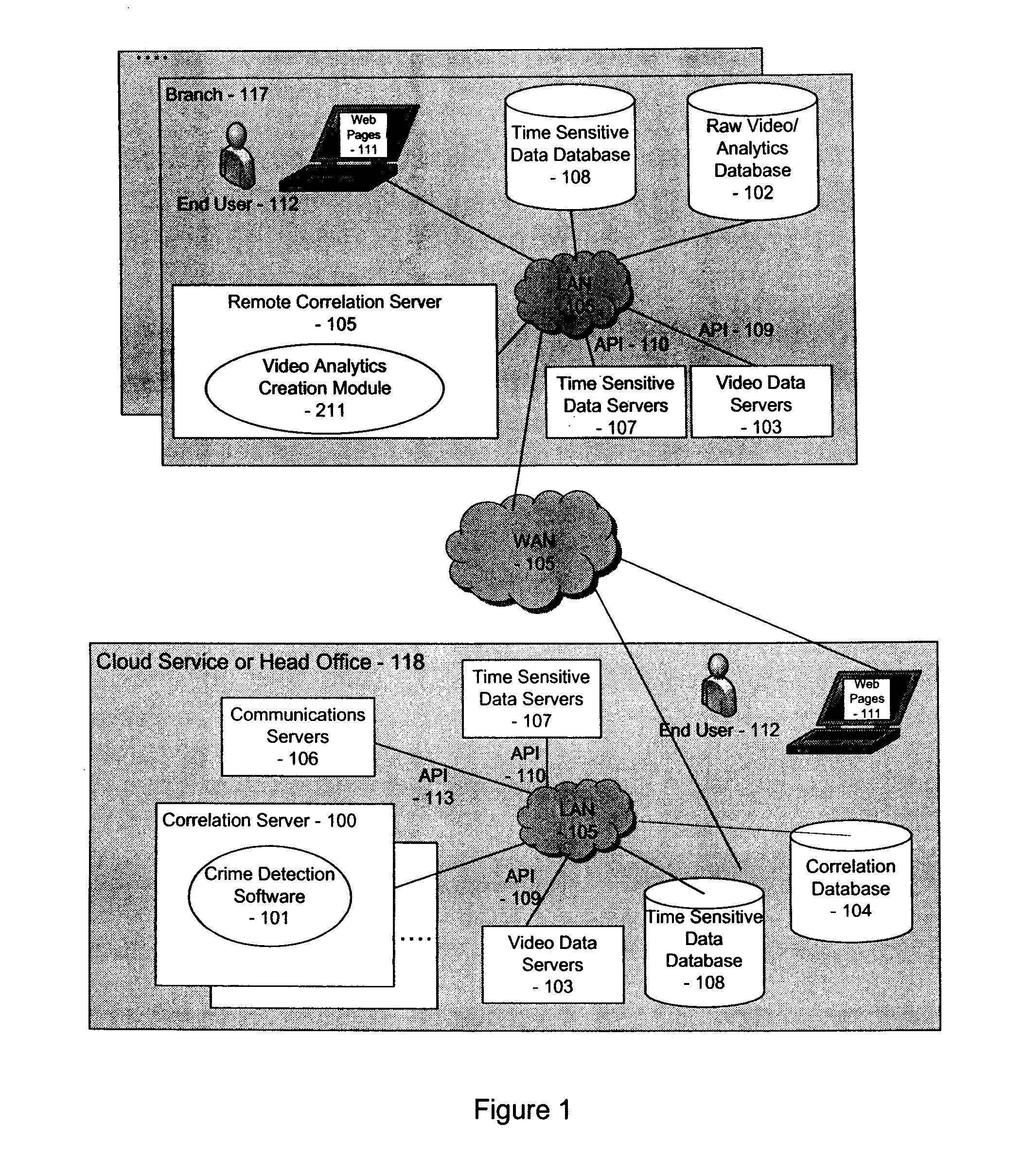

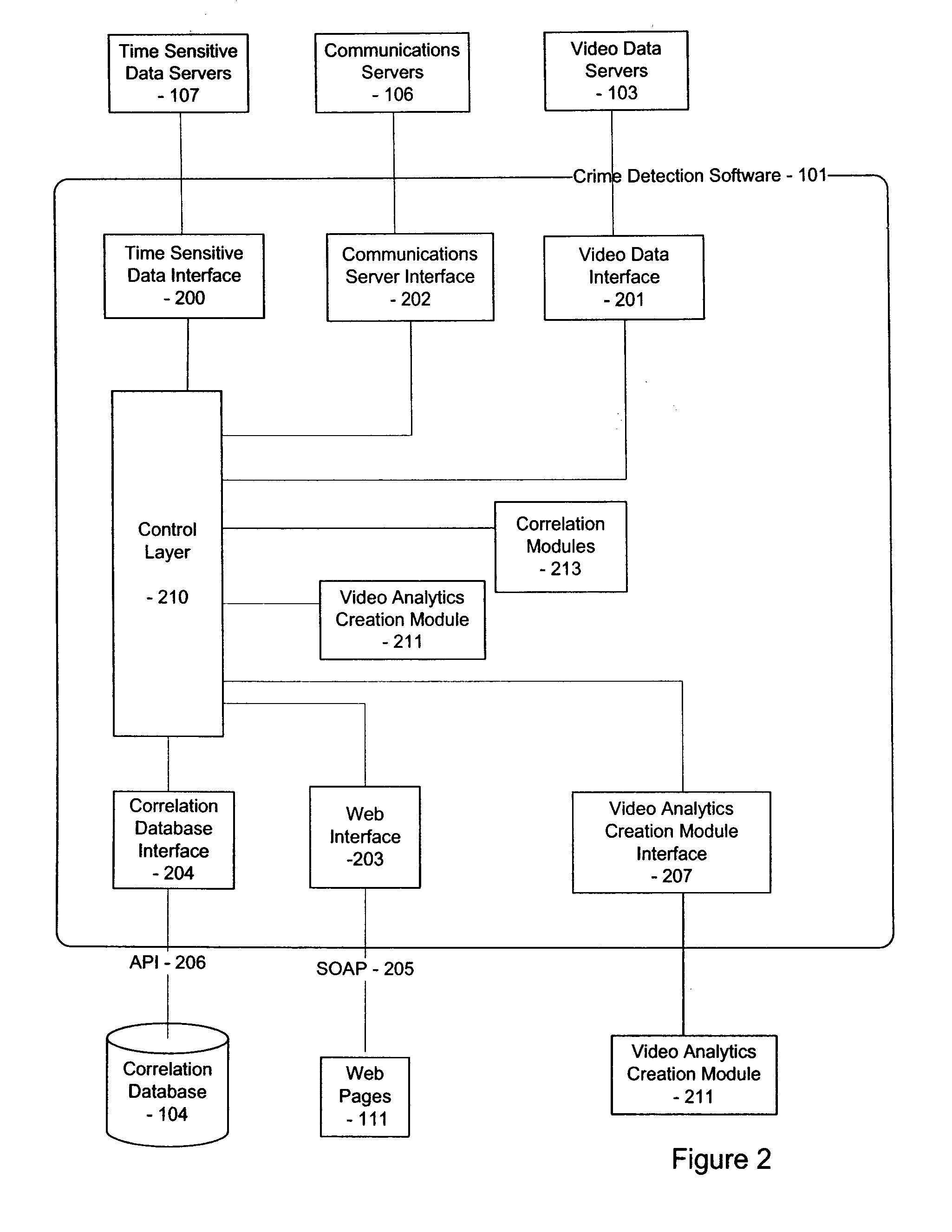

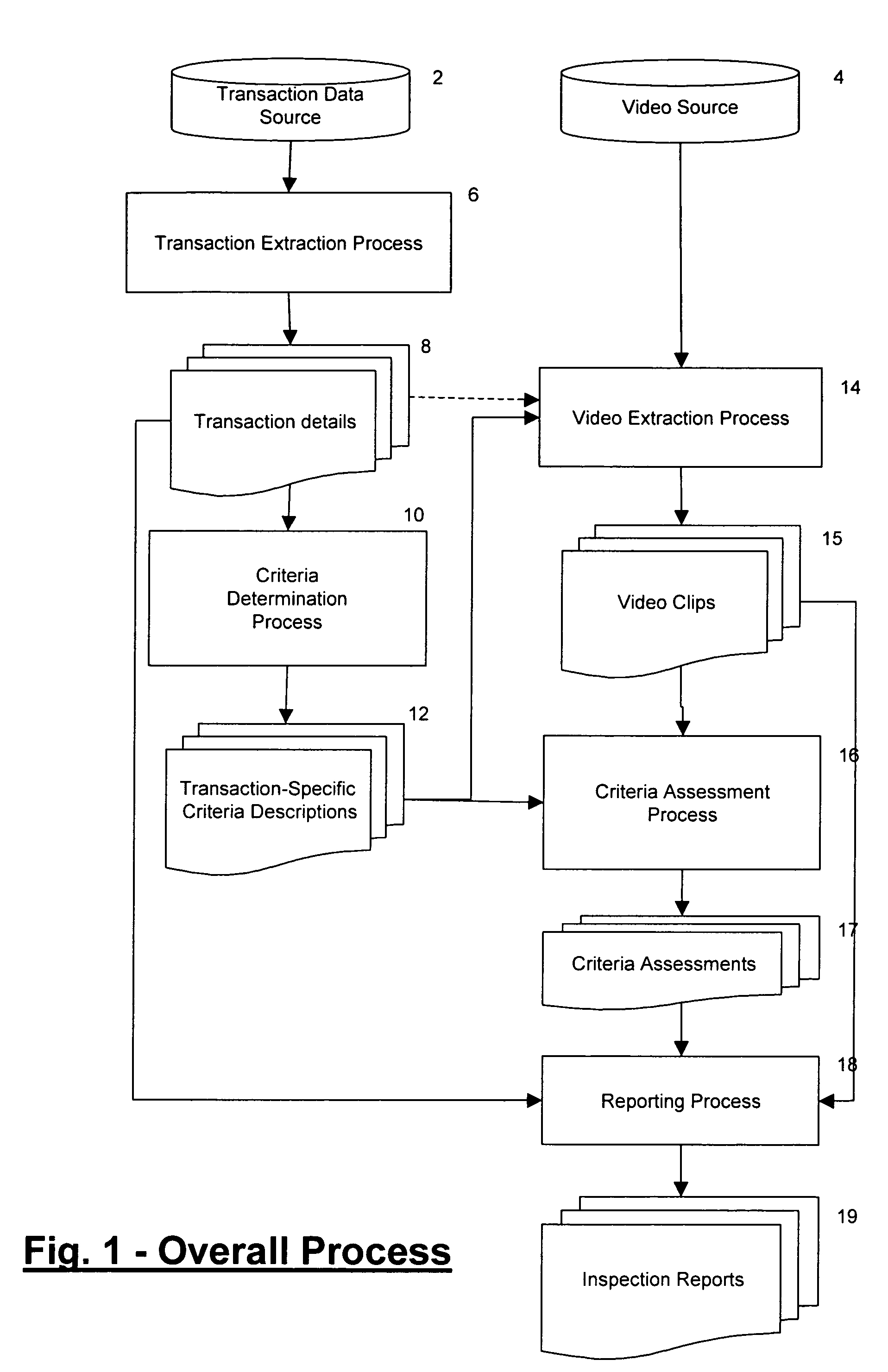

Video analytics system

ActiveUS20140232863A1Easy to findReduce lossesColor television detailsClosed circuit television systemsData streamMonitoring system

A video analytics system includes a first database for storing searchable time-stamped transactional data indicative of activity within a monitored system, a second database for storing time-stamped video metadata, wherein the time-stamped video metadata comprises searchable attributes associated with a raw video data stream; and a rule-based correlation server for comparing the time-stamped transactional data with the time-stamped video metadata to identify correlation events indicating potential activity of interest. An output subsystem reports the correlation events from the correlation engine. The analytics system is useful for detecting fraud in ATM transactions by comparing the transactional data, for example, the presence of a transaction, with video metadata, for example, indicating whether a transaction occurs when a person is present, for how long the person is there.

Owner:SOLINK CORP

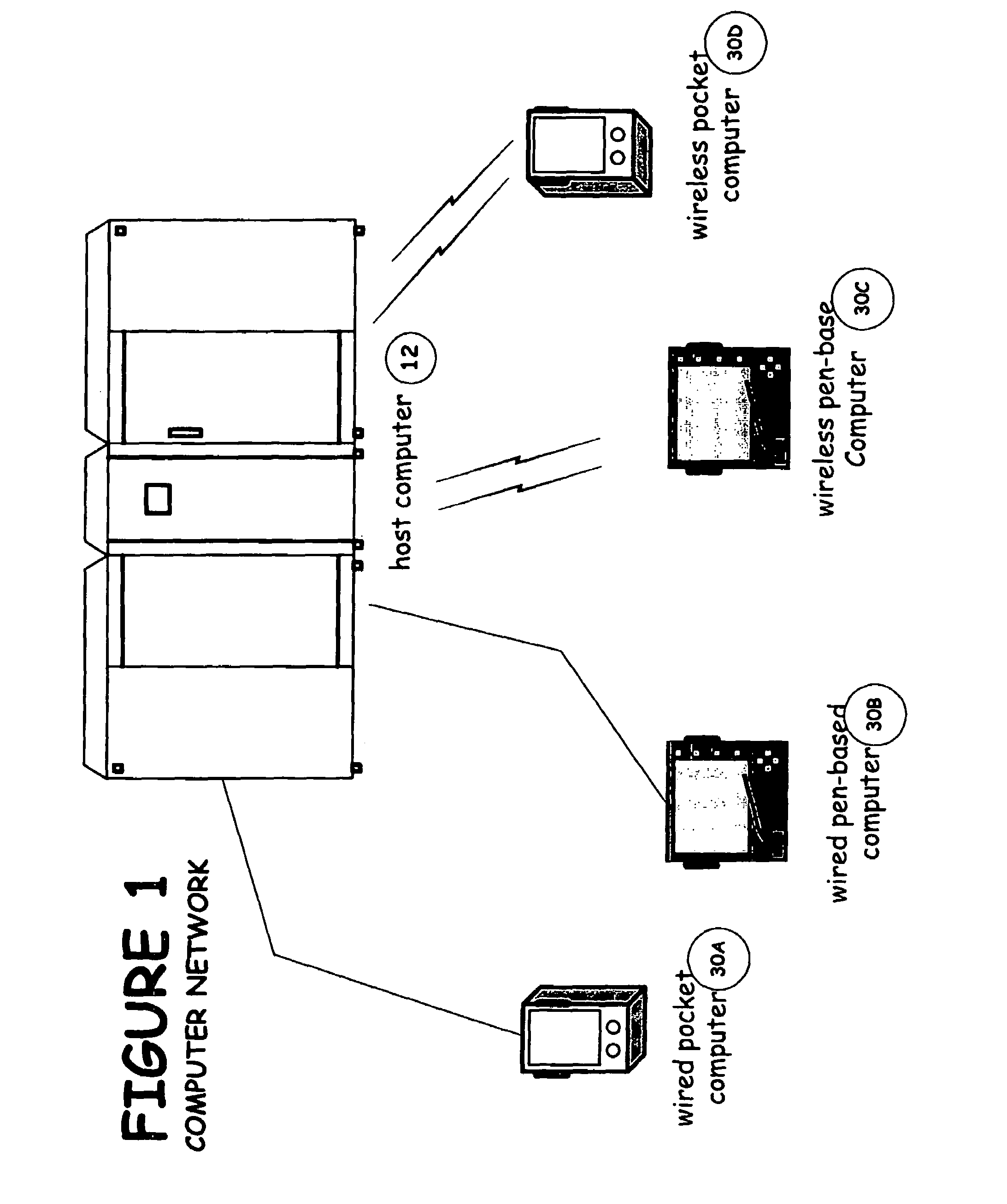

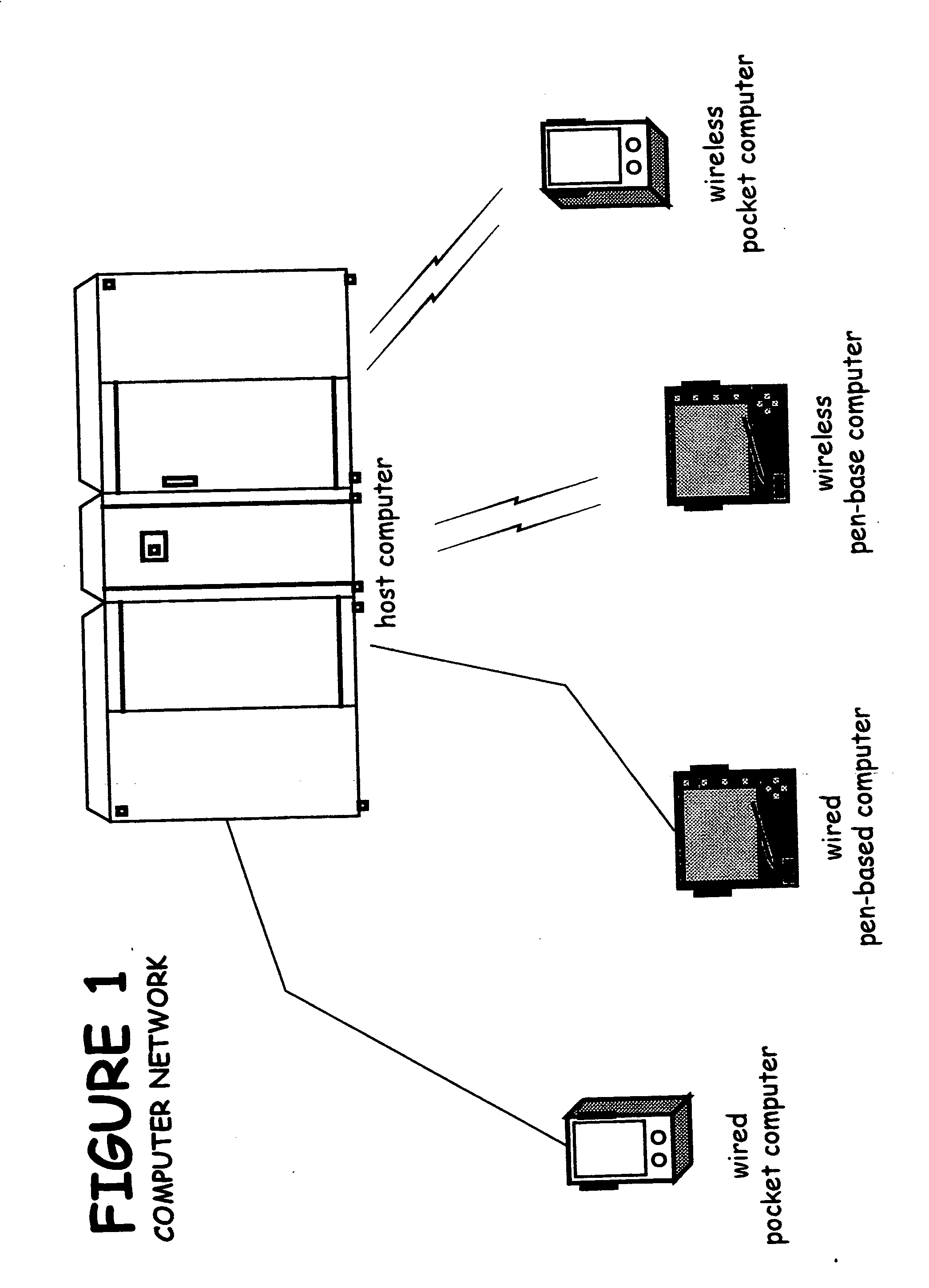

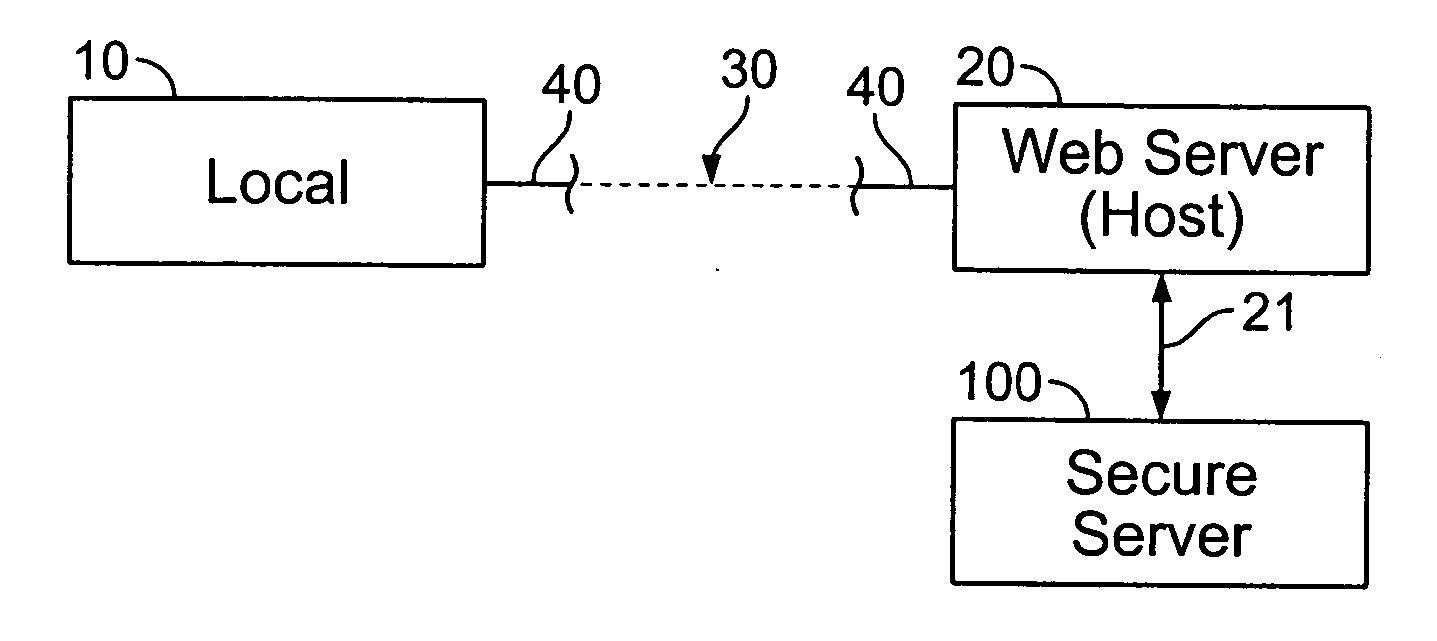

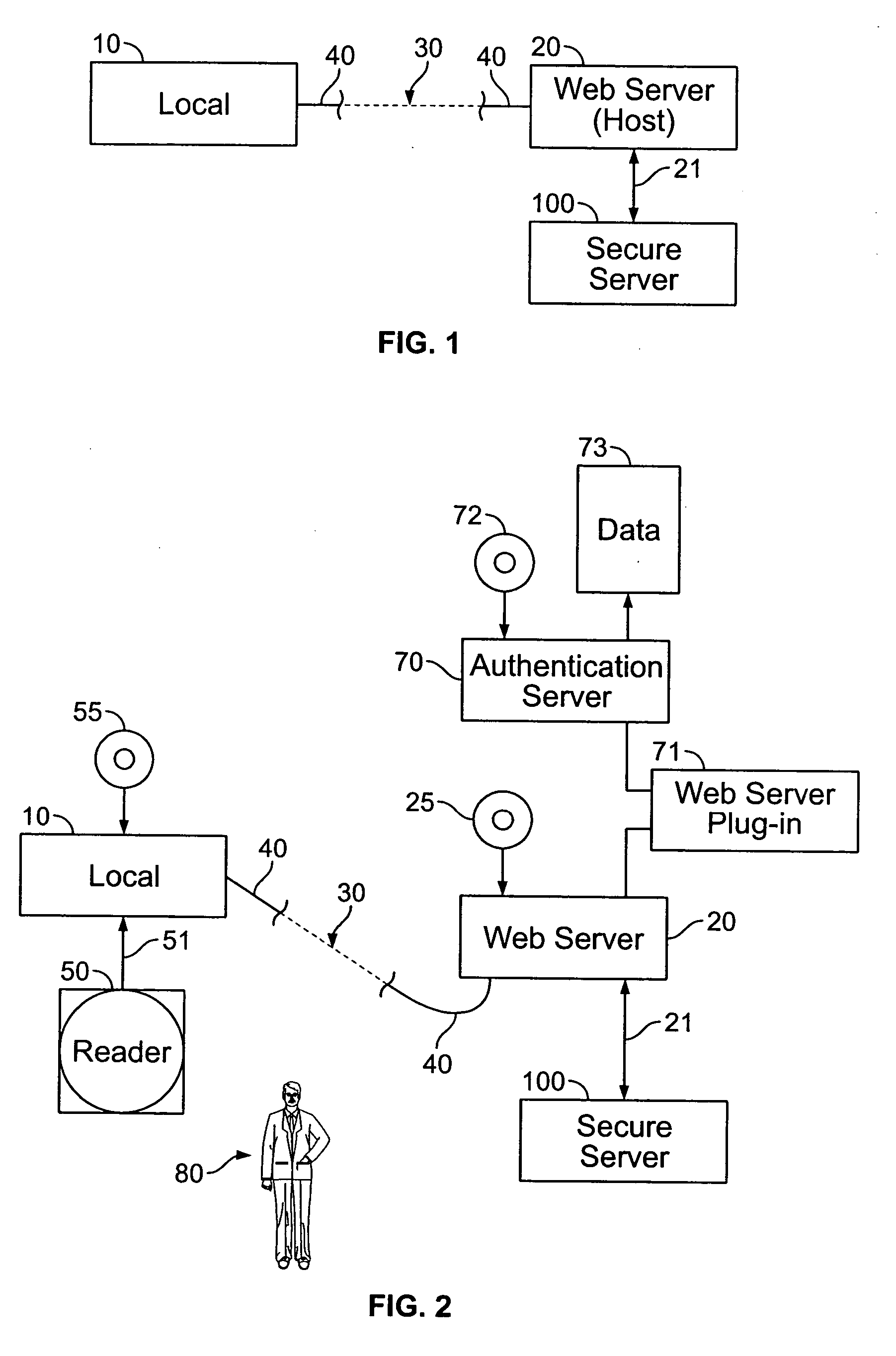

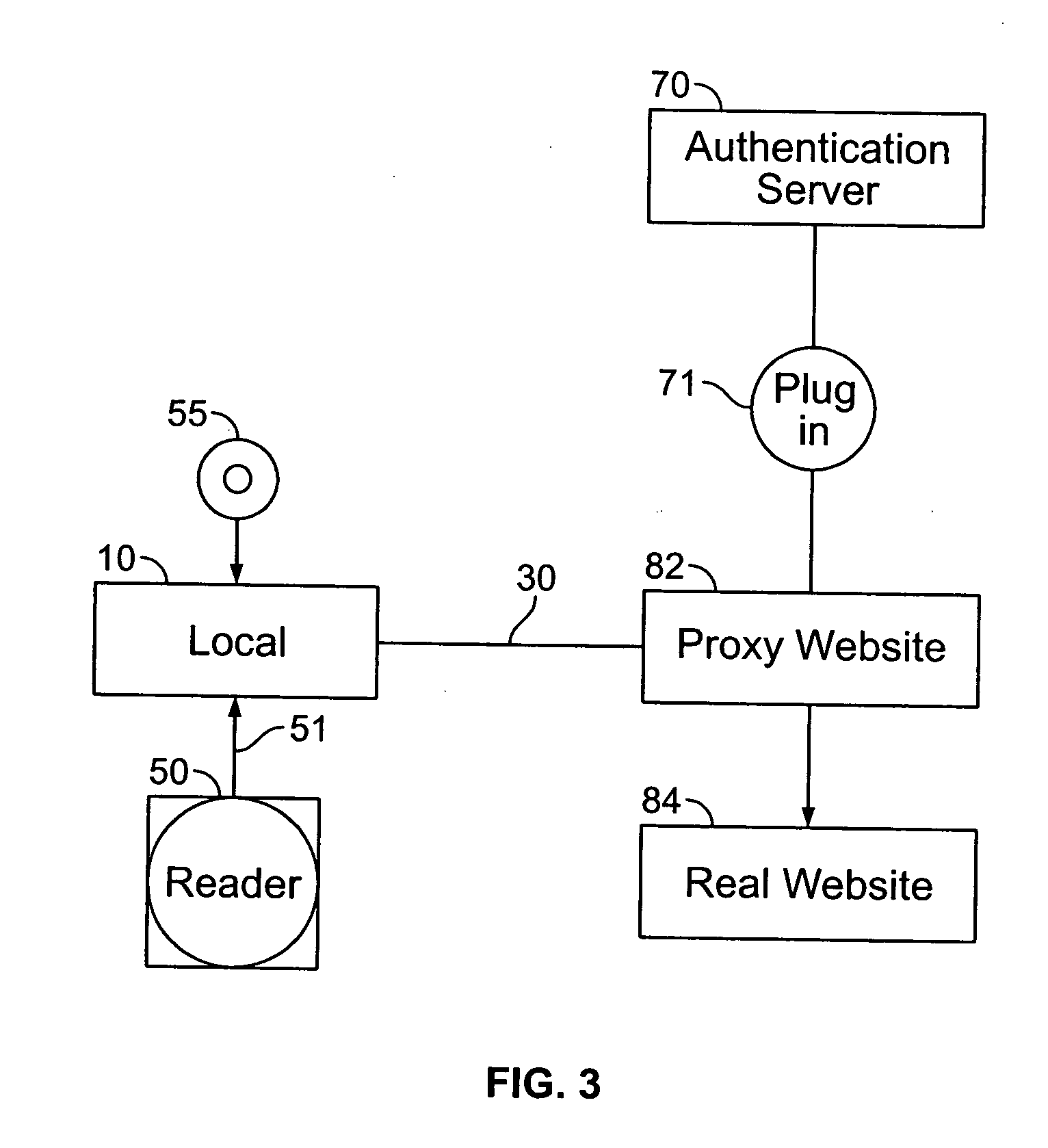

Identification and remote network access using biometric recognition

InactiveUS20070180263A1Easy to monitorEasily keep trackAcutation objectsPayment architectureComputer networkAuthentication server

Apparatuses and methods for setting-up, implementing and using a remote network access using a biometric recognition system is described. The system utilizes a user machine (10), host web server (20), secure server (100), authentication server (70) and controlling programs (72,25) to trigger or prompt and filter information.

Owner:US BIOMETRICS

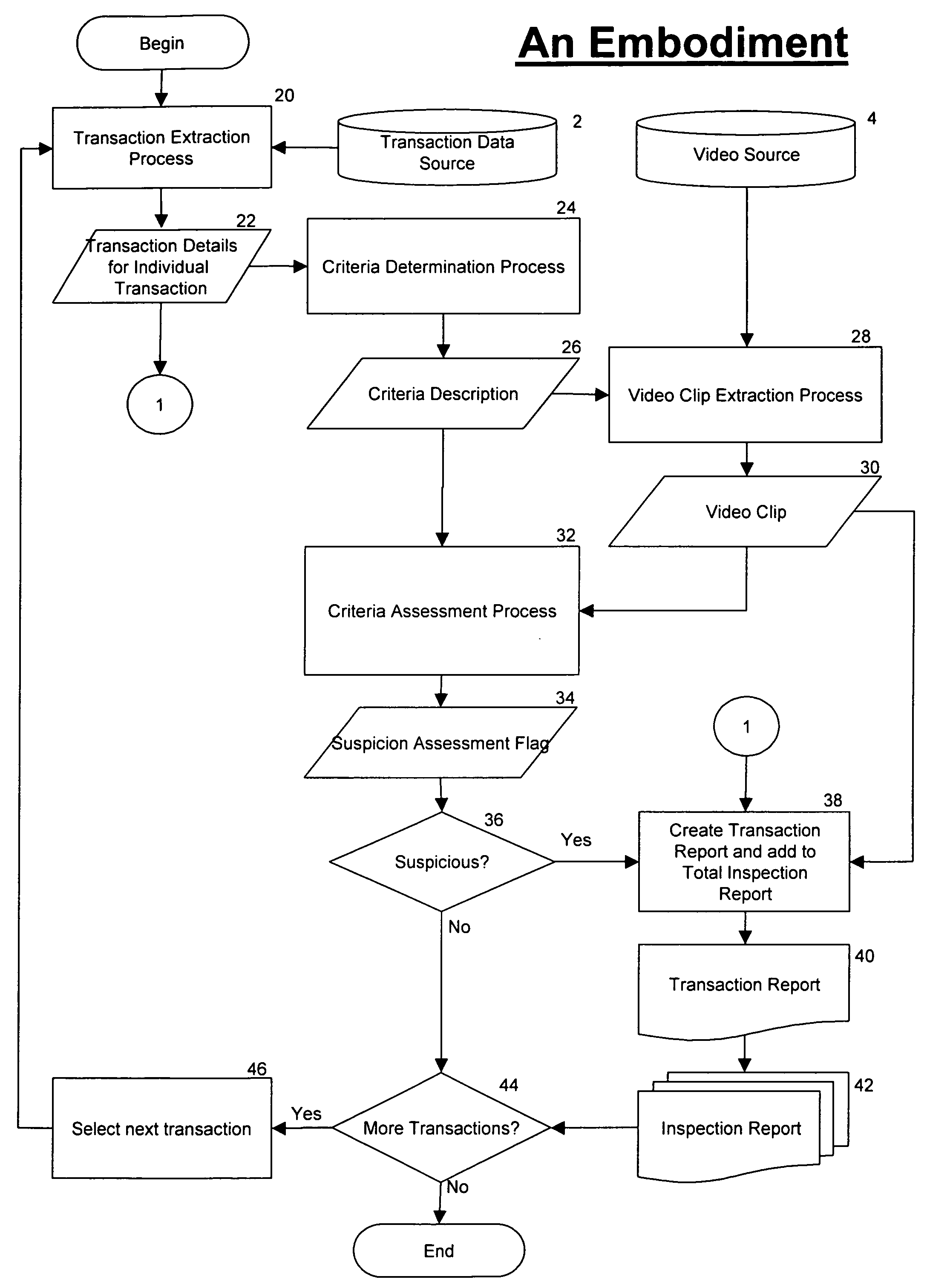

Method and apparatus for auditing transaction activity in retail and other environments using visual recognition

ActiveUS7516888B1Quick identificationShorten the timePayment architectureApparatus for meter-controlled dispensingTransaction dataFinancial transaction

A system detects a transaction outcome by obtaining video data associated with a transaction area and by obtaining transaction data concerning at least one transaction that occurs at the transaction area. The system correlates the video data associated with the transaction area to the transaction data to identify specific video data captured during occurrence of that at least one transaction at the transaction area. Based a transaction classification indicated by the transaction data, the system processes the video data to identify appropriate visual indicators within the video data that correspond to the transaction classification.

Owner:NCR CORP

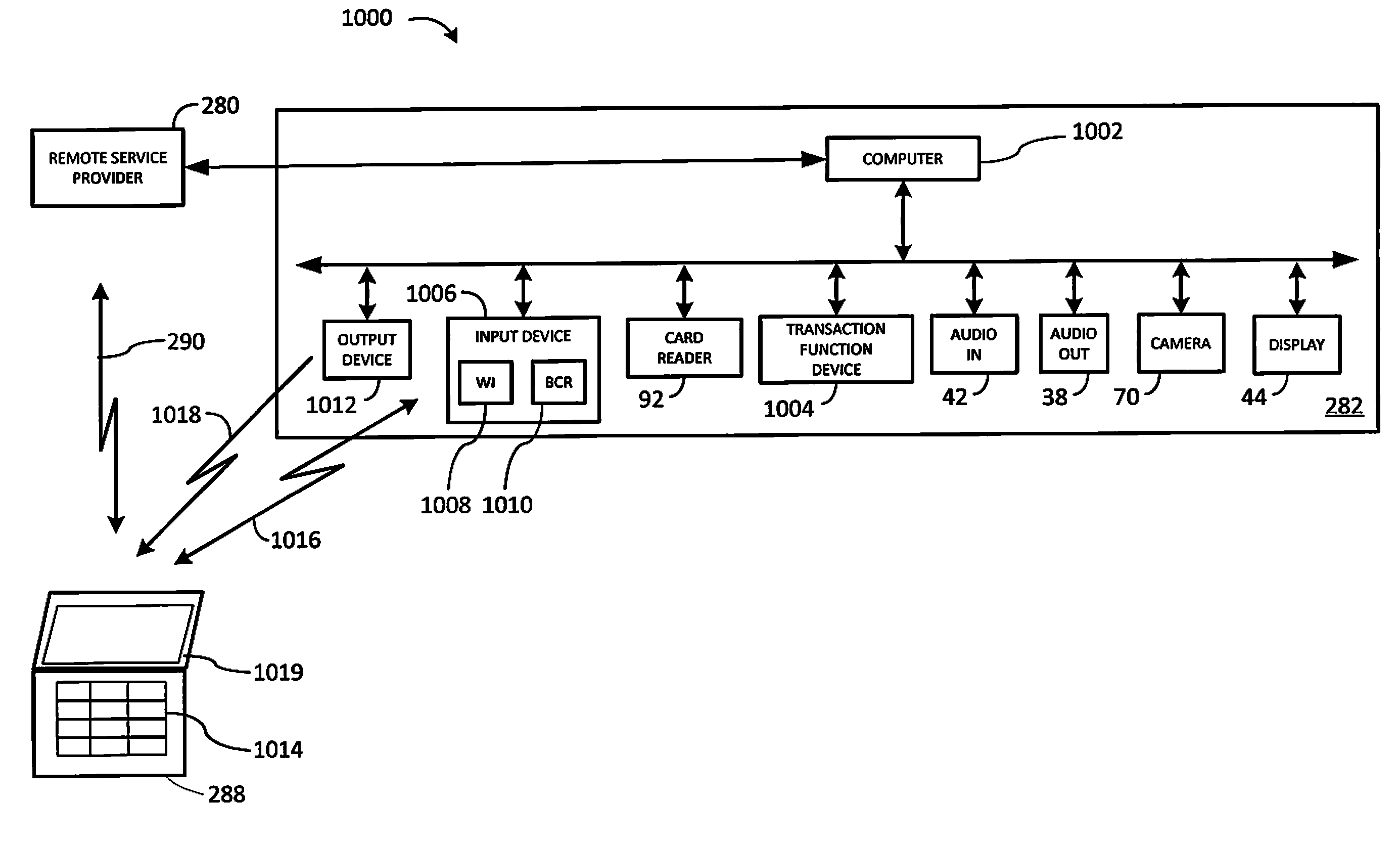

Automated banking machine with remote user assistance

InactiveUS8955743B1Accelerating transactionResponses generated by the at least one computer may be made quicker and shorterComplete banking machinesFinanceEngineeringUser assistance

In an example embodiment, an automated banking machine that allows a customer to employ a mobile wireless device for performing banking transactions. The customer may request assistance from a teller or other bank personnel at a remote location. An audio, and optionally video, communication may be initiated between the remote location and the customer. The customer may use either the automated banking machine, mobile wireless device, or both for communicating with the remote location.

Owner:DIEBOLD SELF SERVICE SYST DIV OF DIEBOLD NIXDORF INC

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com