Patents

Literature

251 results about "Biometric system" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

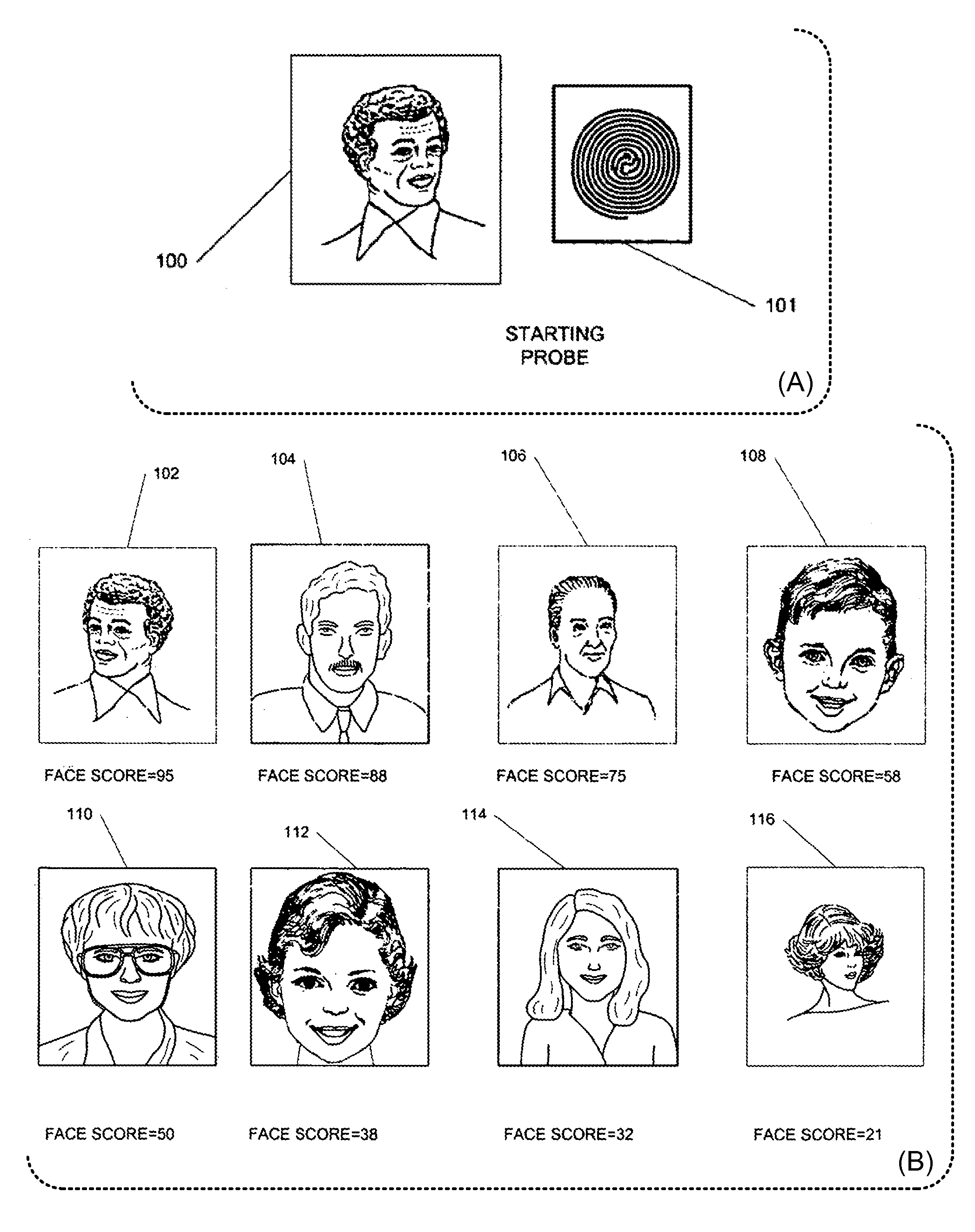

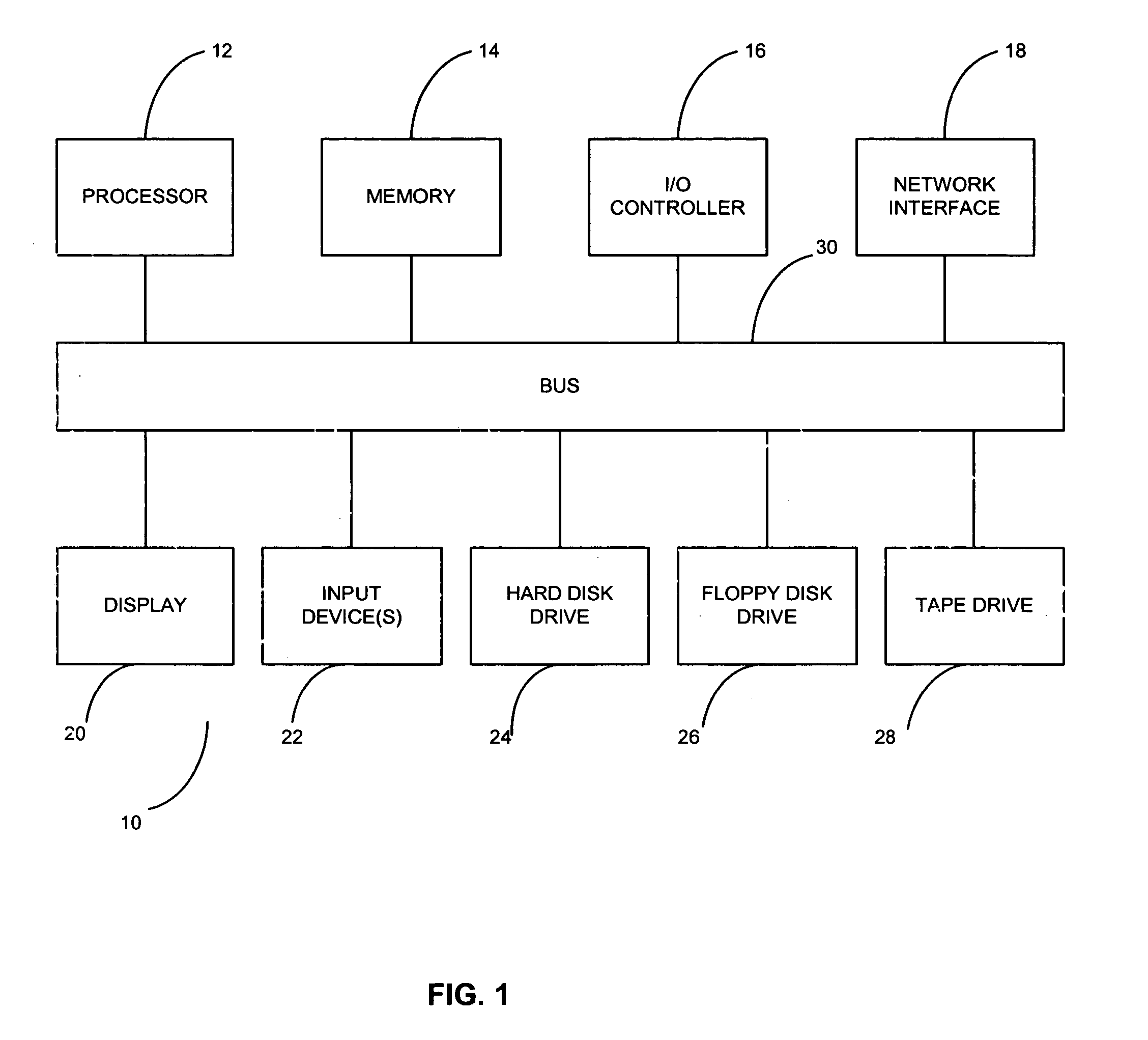

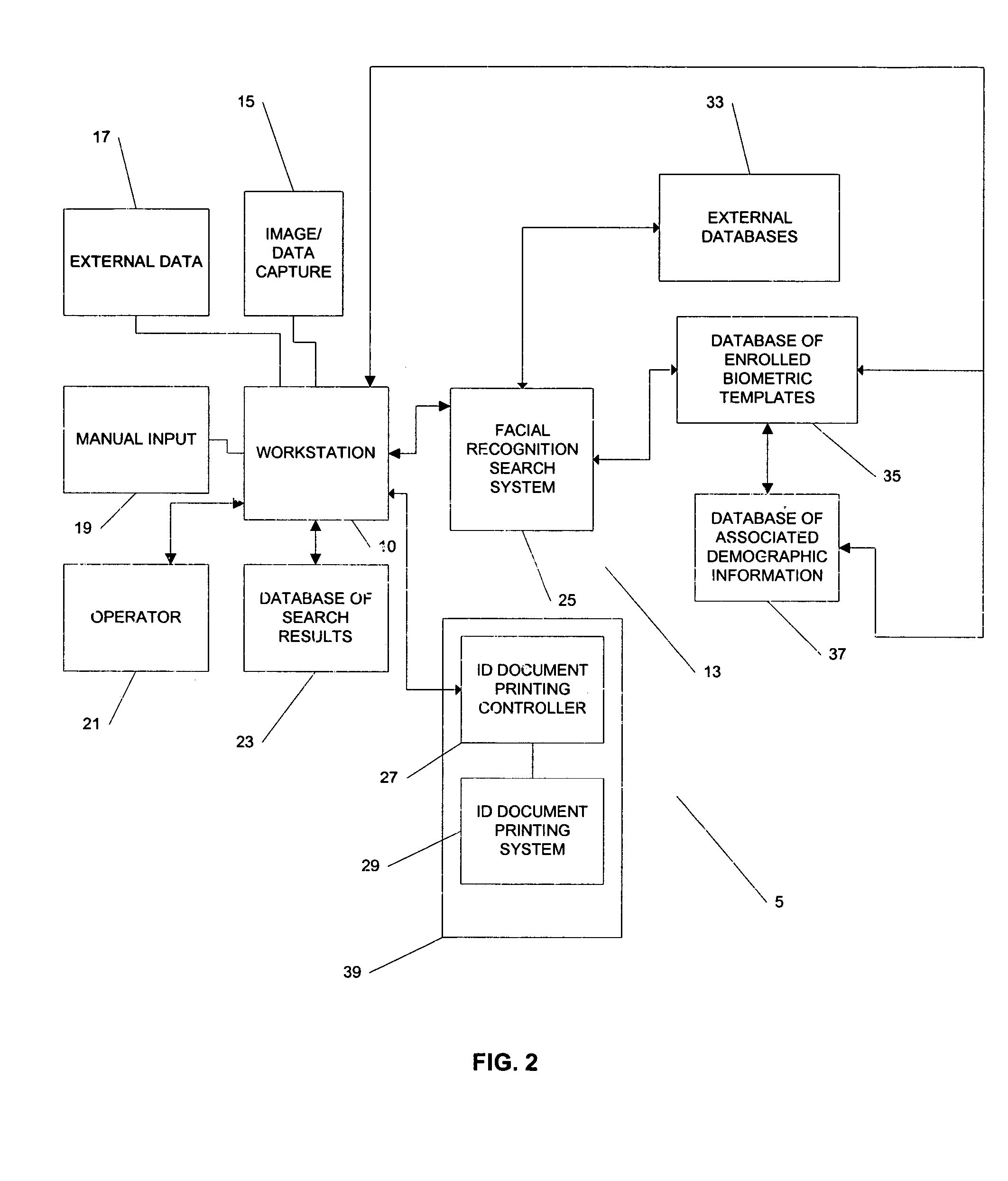

Systems and methods for managing and detecting fraud in image databases used with identification documents

ActiveUS7804982B2Prevent fraudReduce theftCharacter and pattern recognitionIndividual entry/exit registersDocument preparationWorkstation

We provide a system for issuing identification documents to a plurality of individuals, comprising a first database, a first server, and a workstation. The first database stores a plurality of digitized images, each digitized image comprising a biometric image of an individual seeking an identification document. The first server is in operable communication with the first database and is programmed to send, at a predetermined time, one or more digitized images from the first database to a biometric recognition system, the biometric recognition system in operable communication with a second database, the second database containing biometric templates associated with individuals whose images have been previously captured, and to receive from the biometric recognition system, for each digitized image sent, an indicator, based on the biometric searching of the second database, as to whether the second database contains any images of individuals who may at least partially resemble the digitized image that was sent. The a workstation is in operable communication with the first server and is configured to permit a user to review the indicator and to make a determination as to whether the individual is authorized to be issued an identification document or to keep an identification document in the individual's possession.

Owner:L 1 SECURE CREDENTIALING

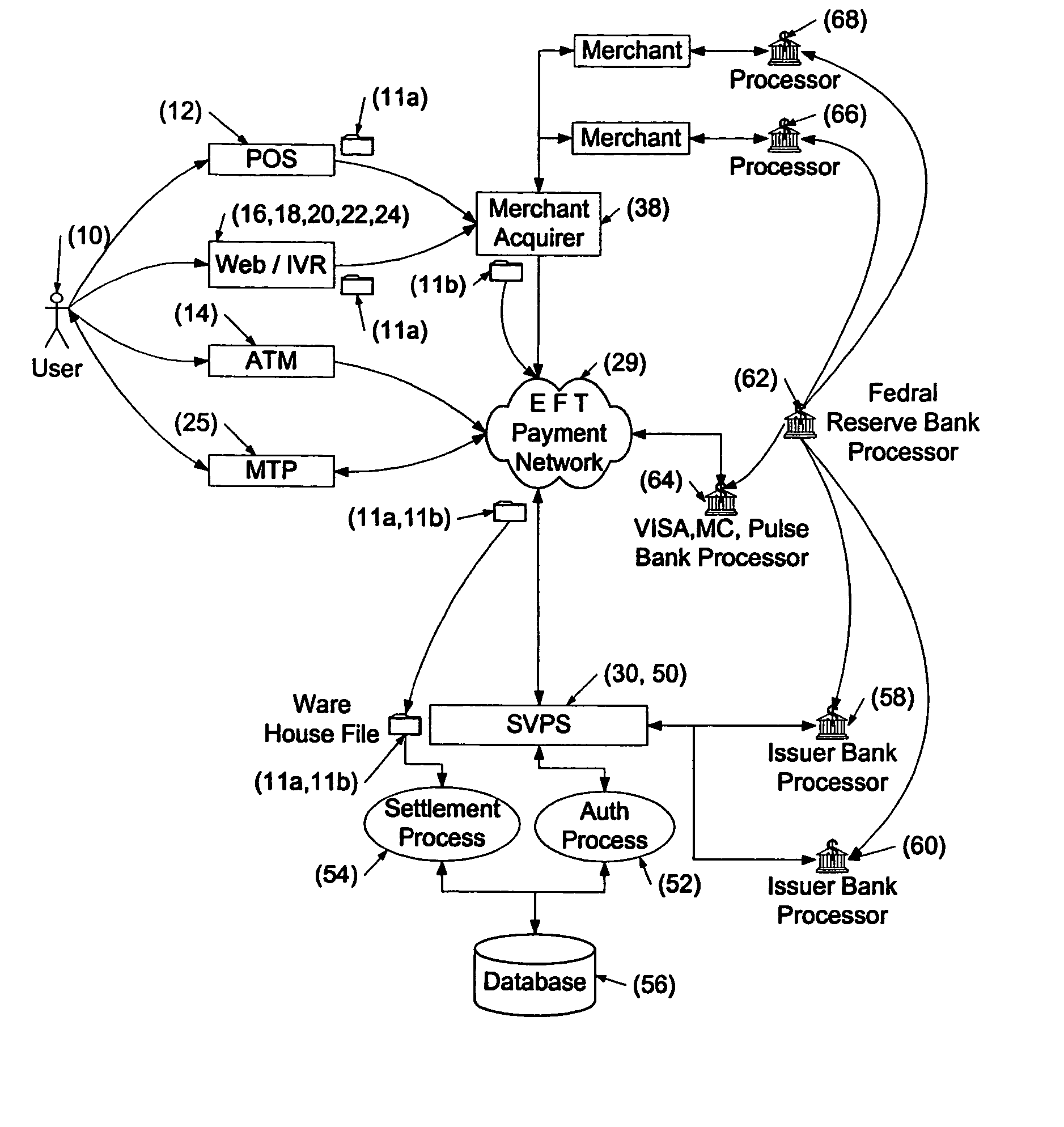

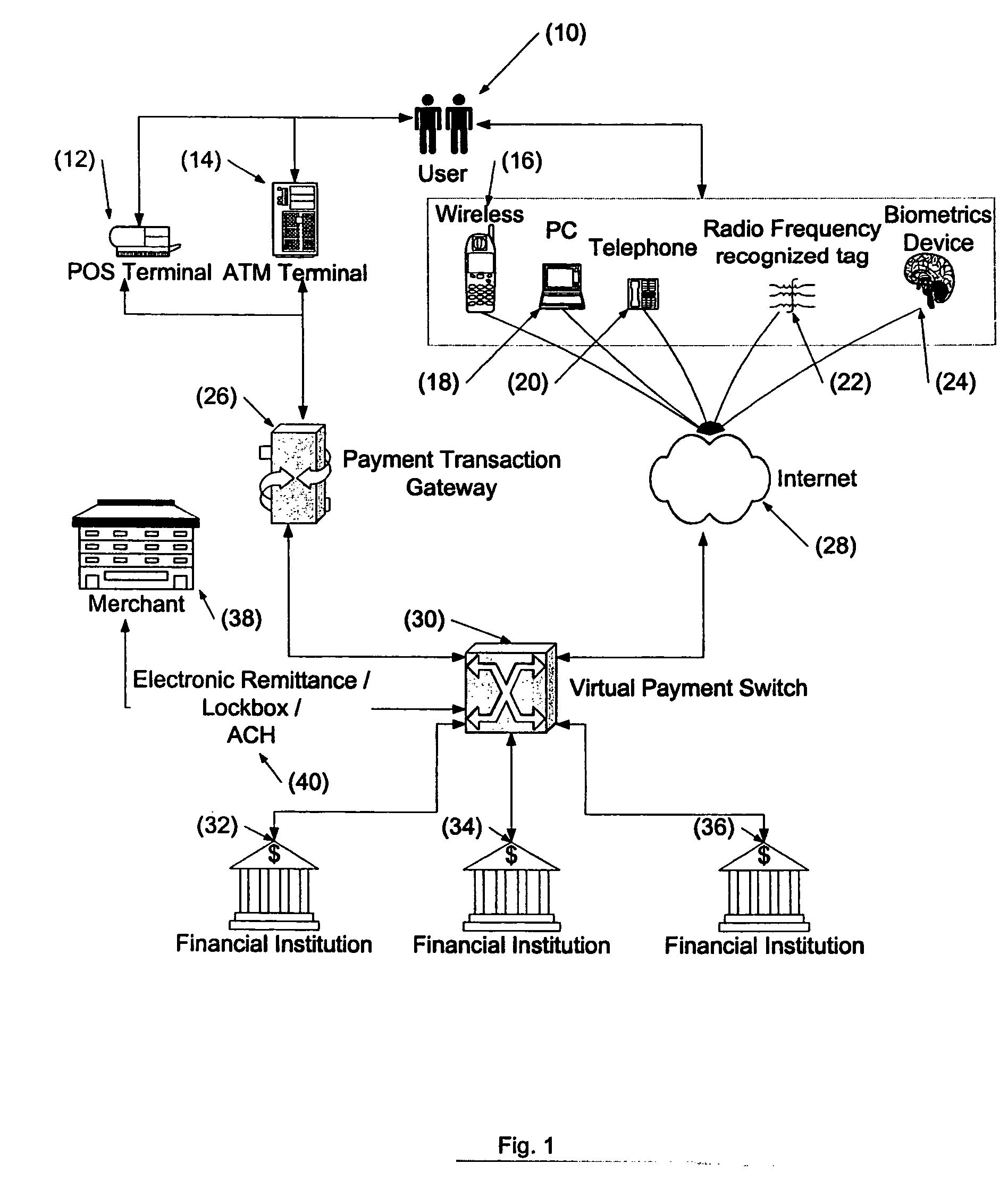

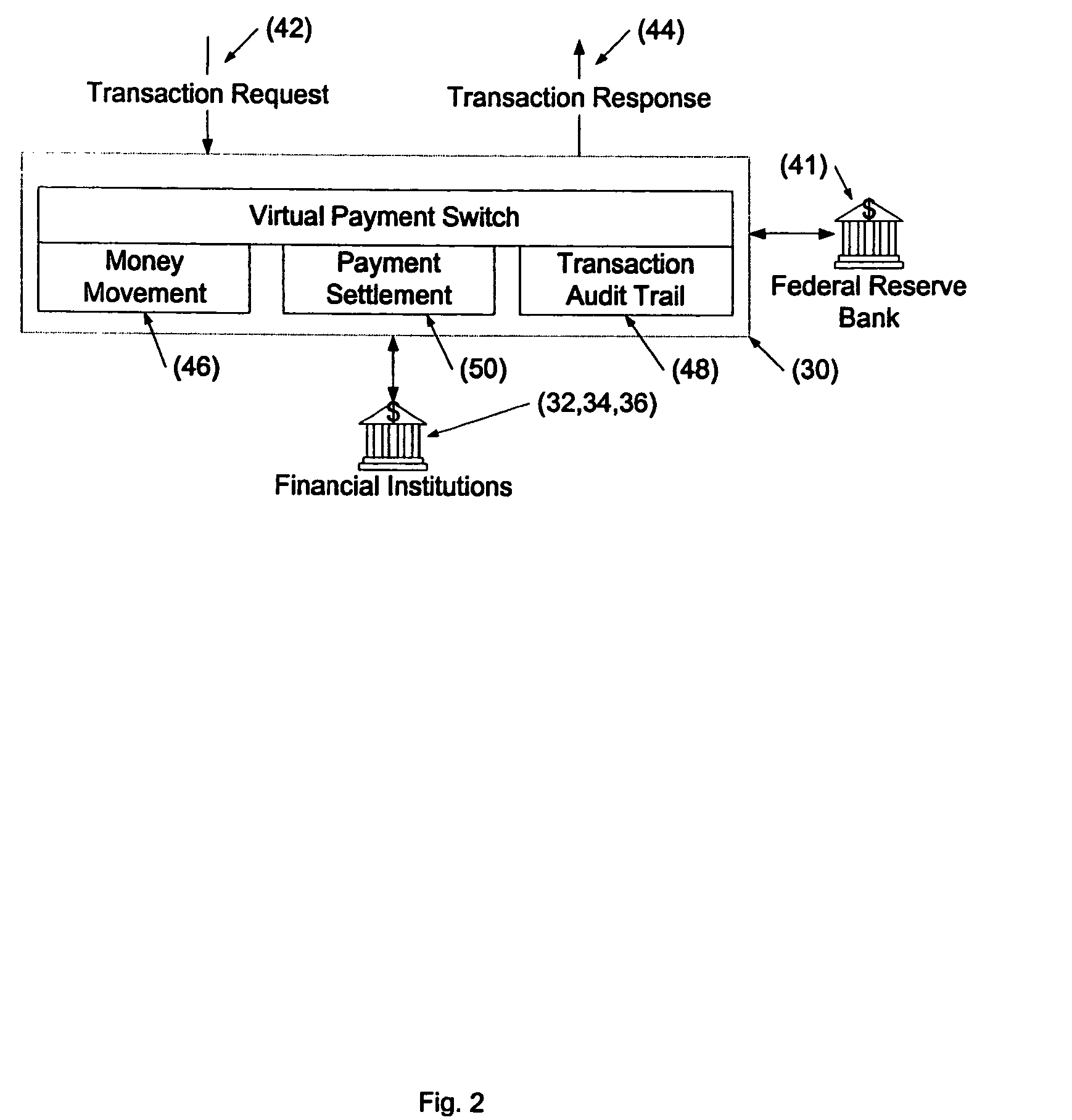

Cashless payment system

InactiveUS20050015332A1Without any loss of transaction processing flexibilityWidespread acceptanceFinanceBuying/selling/leasing transactionsComputer networkEngineering

A payment system that does not rely on credit or debit cards, does not require the merchant and purchaser to have compatible memberships to complete a transaction, and does not limit single transactions to a single account provides a wide range of flexibility permitting debit, credit, pre-paid and payroll cards to be accommodated in a seamless and invisible manner to the electronic transaction network. The transaction may be verified and approved at the point-of-sale whether or not the merchant is a member of a specific financial transaction system. Specifically, the point-of-sale transaction system permits an identified customer to use any of a variety of payment options to complete the transaction without requiring the merchant to pre-approve the type of payment selected by the customer. In one configuration, and in order to take advantage of the widespread use of the ATM / POS network, the invention uses a typical credit / debit card format to provide the identifying information in a stored value card. When a transaction is to be completed, the user enters the identifying information carried on the card at the point-of-sale. This can be a merchant or other service provider at a retail establishment, or on-line while the user is logged onto a web site, or other location. The information can be swiped by a card reader, or manually entered via a keyboard or other input device. The system supports a wide range of flexibility, permitting issuing systems such as parents and state welfare agencies to restrict the types of authorized uses, and permitting users to access accounts in a prioritized manner. Further, the accepting merchant is not required to be a member because settlement with the merchant may be made via the Federal Reserve Automatic Clearing House (ACH) system by typical and standard electronic transfer. This permits the merchant to take advantage of the lower ACH transaction fees with even greater convenience and flexibility than the current ATM / POS system. The system supports numerous types of identification methods from typical credit card structures with magnetic data strips to various biometric systems such as finger prints, facial recognition and the like. Specifically, once the user is identified, the transaction is managed by his membership data on record with the transaction processing system.

Owner:ECOMMLINK

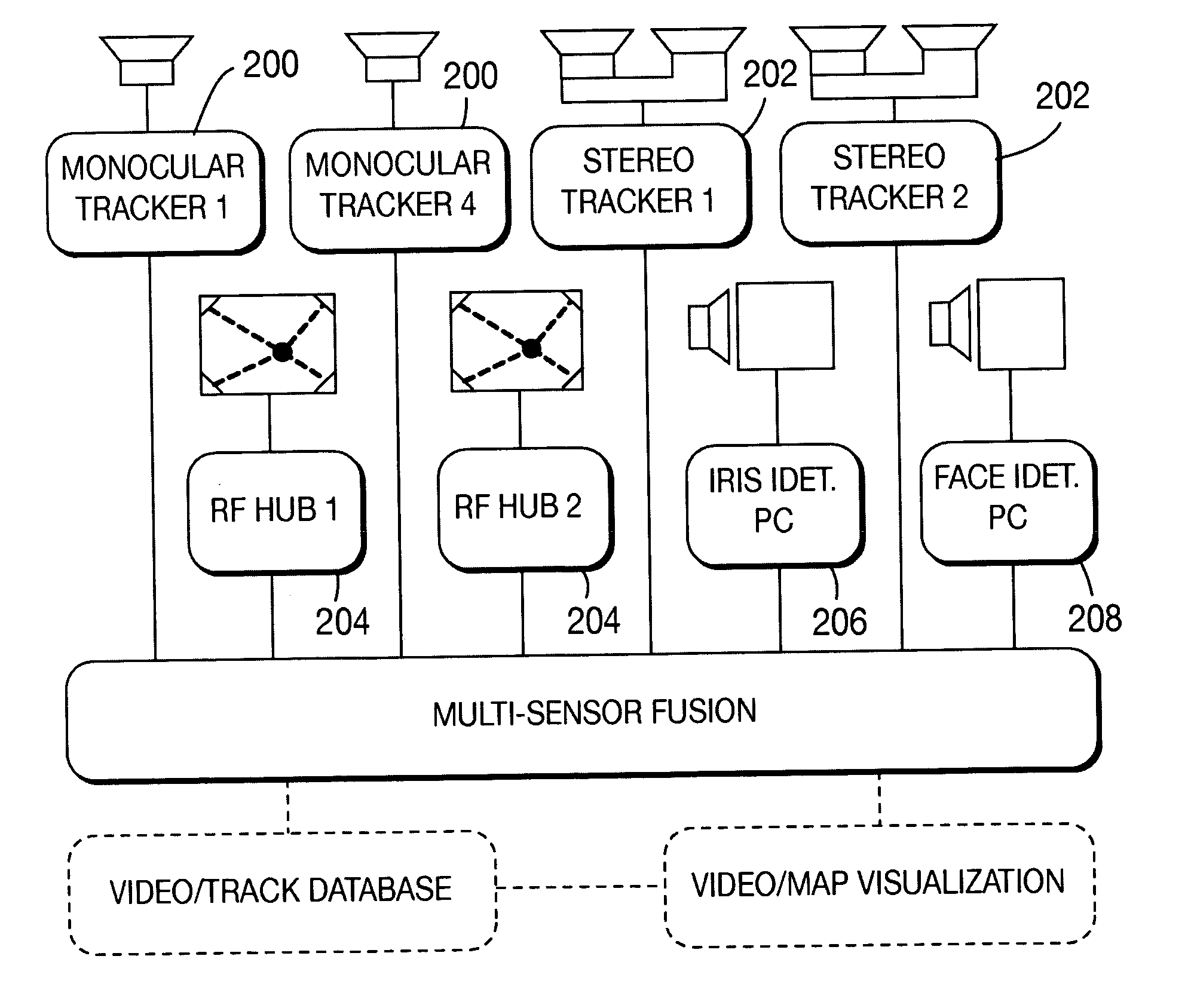

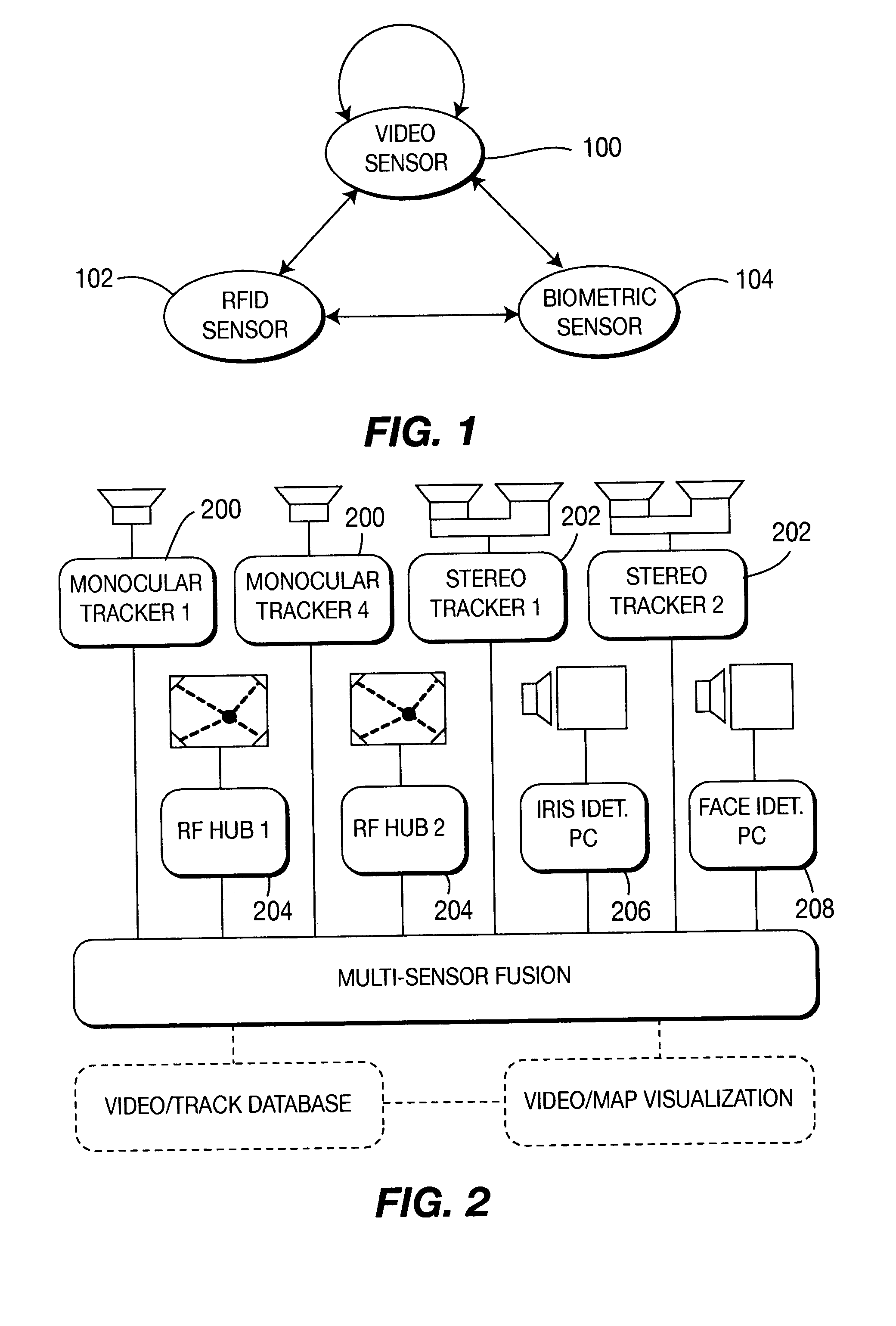

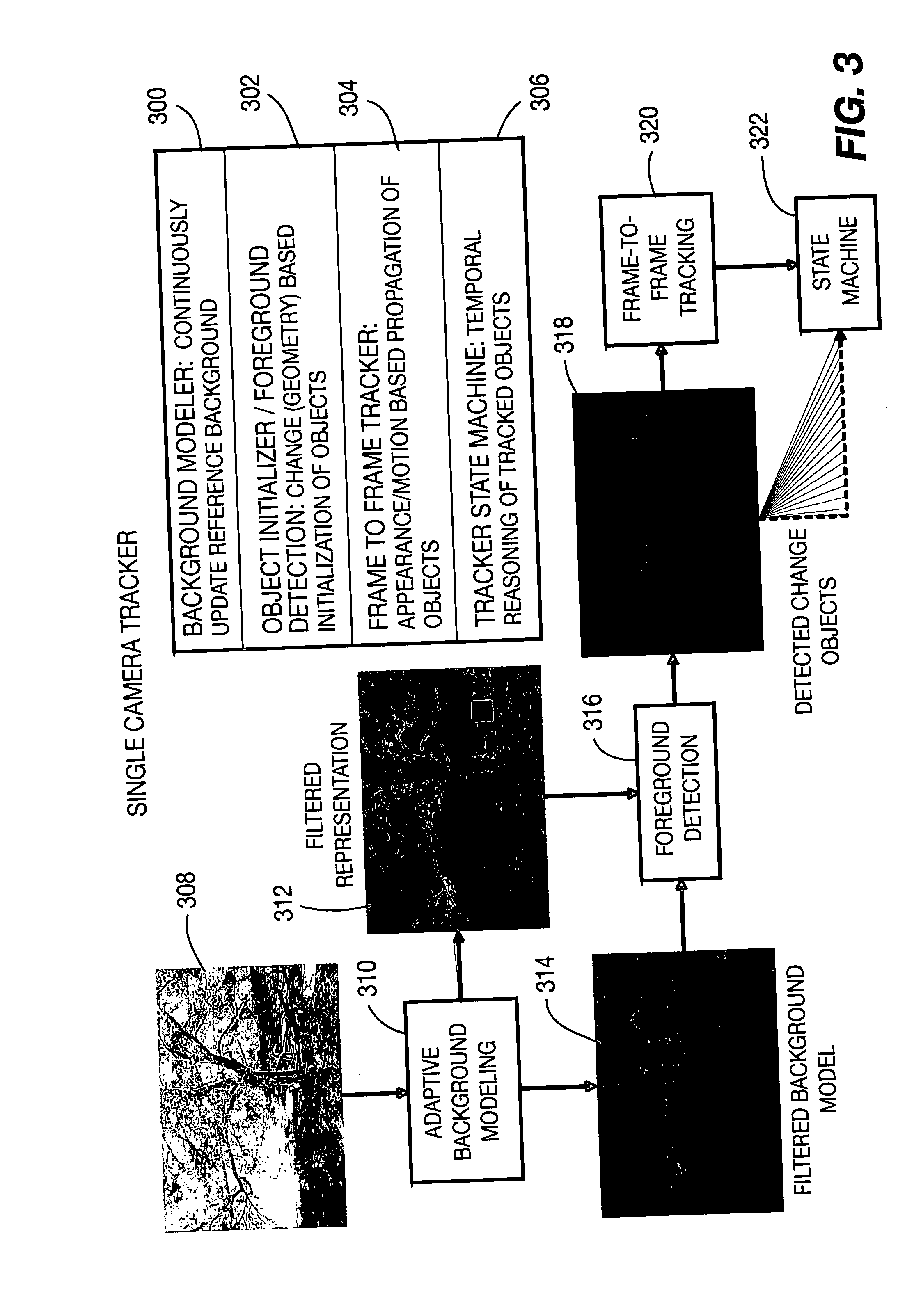

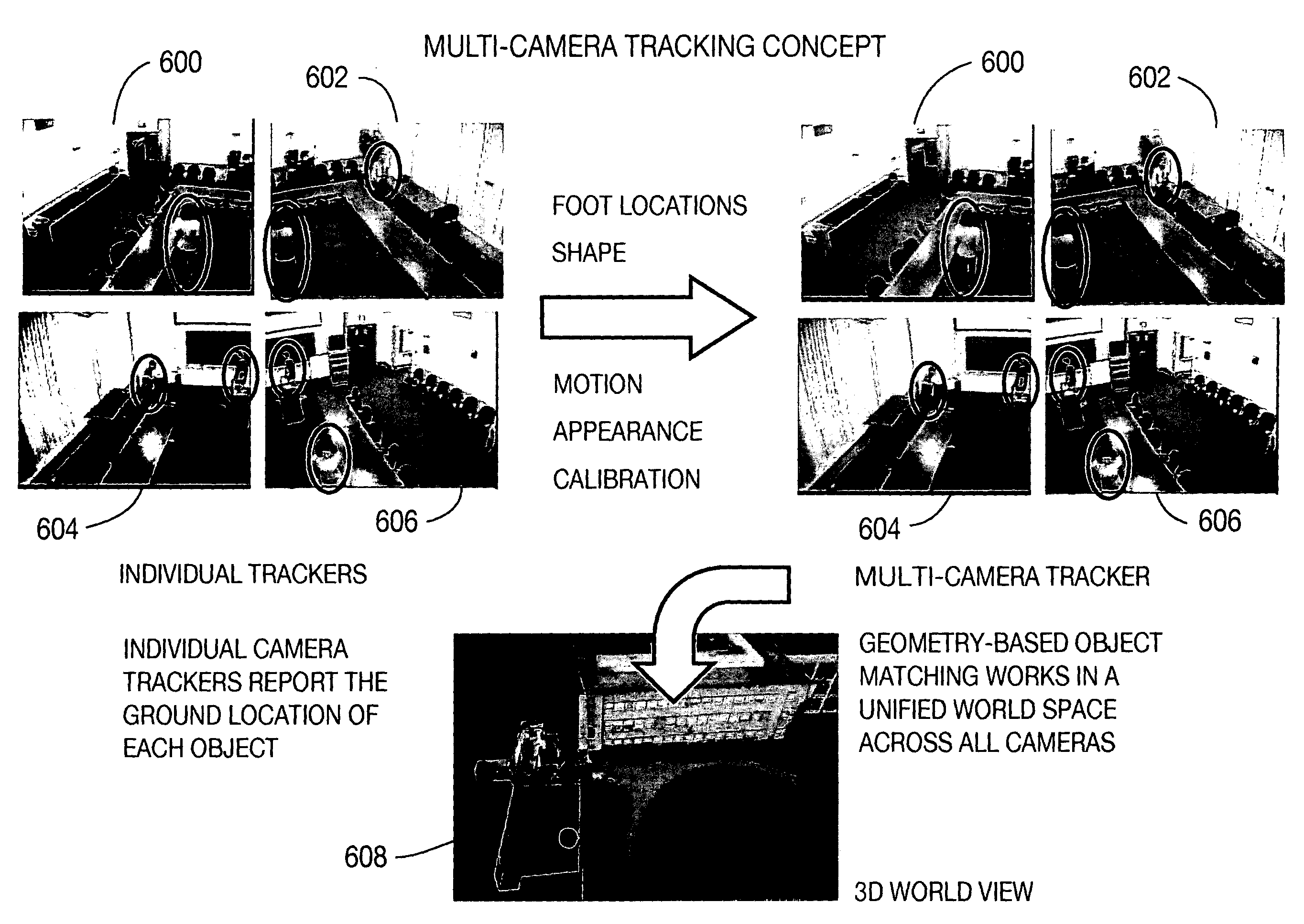

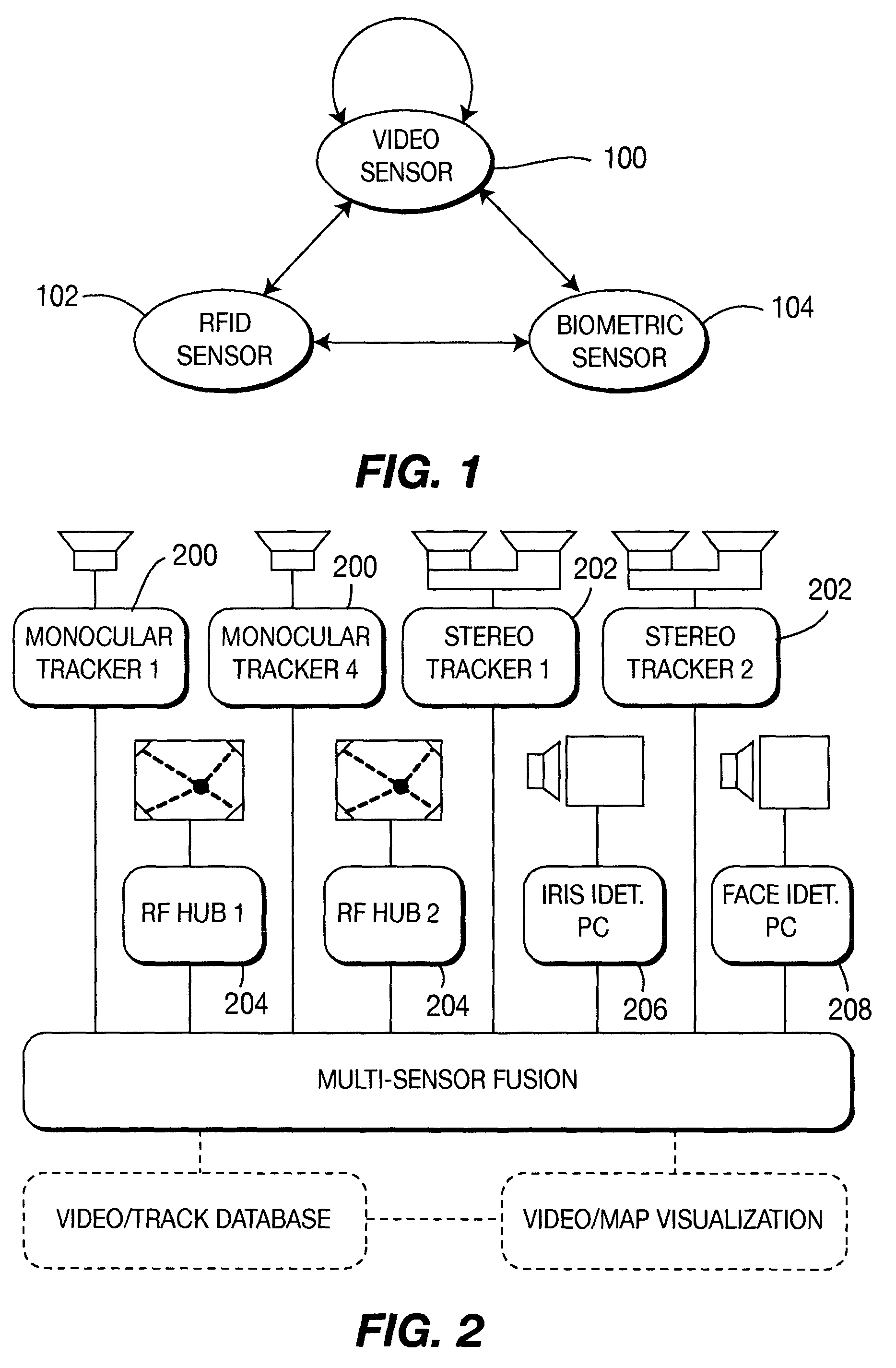

Method and apparatus for stereo, multi-camera tracking and RF and video track fusion

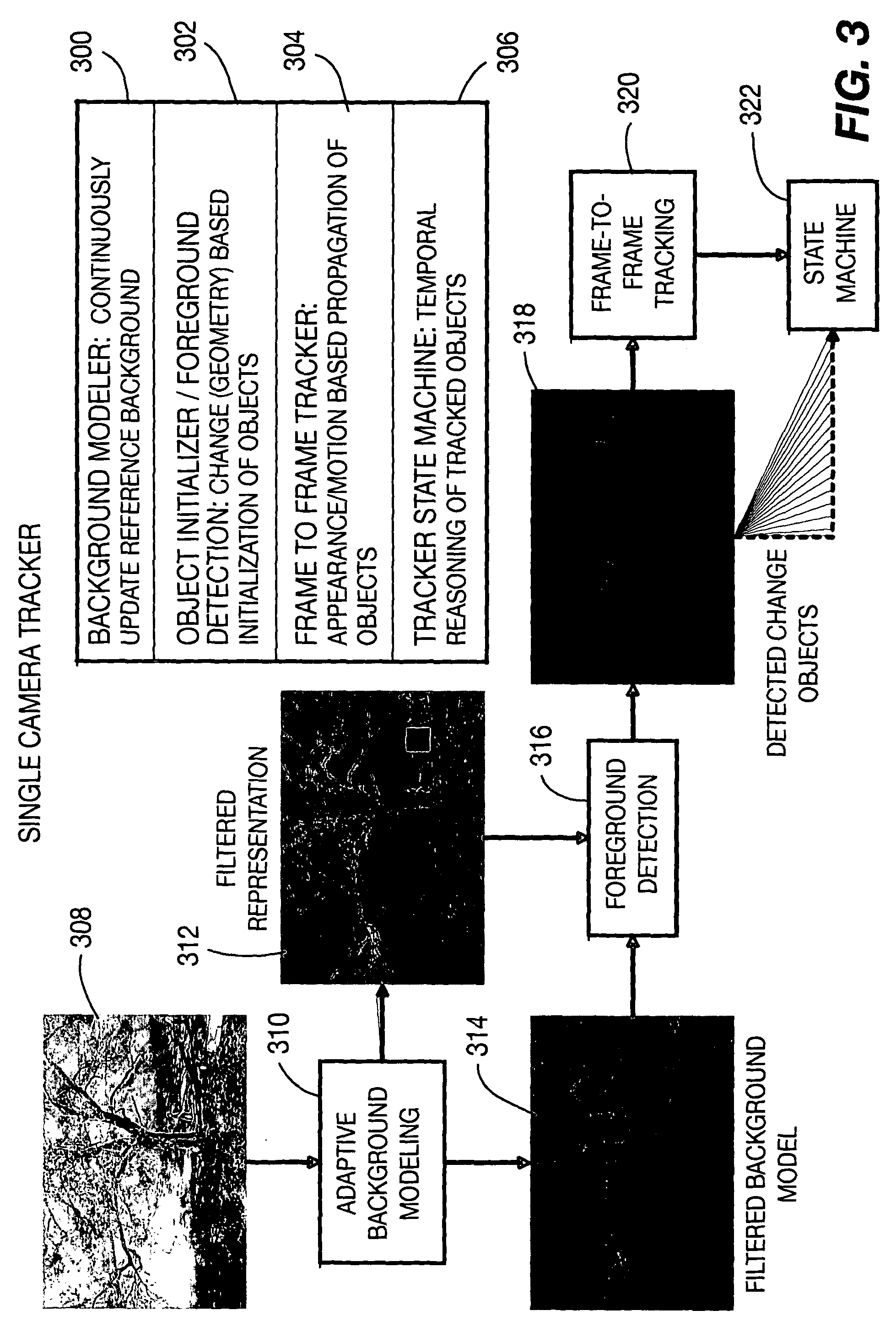

A unified approach, a fusion technique, a space-time constraint, a methodology, and system architecture are provided. The unified approach is to fuse the outputs of monocular and stereo video trackers, RFID and localization systems and biometric identification systems. The fusion technique is provided that is based on the transformation of the sensory information from heterogeneous sources into a common coordinate system with rigorous uncertainties analysis to account for various sensor noises and ambiguities. The space-time constraint is used to fuse different sensor using the location and velocity information. Advantages include the ability to continuously track multiple humans with their identities in a large area. The methodology is general so that other sensors can be incorporated into the system. The system architecture is provided for the underlying real-time processing of the sensors.

Owner:SRI INTERNATIONAL

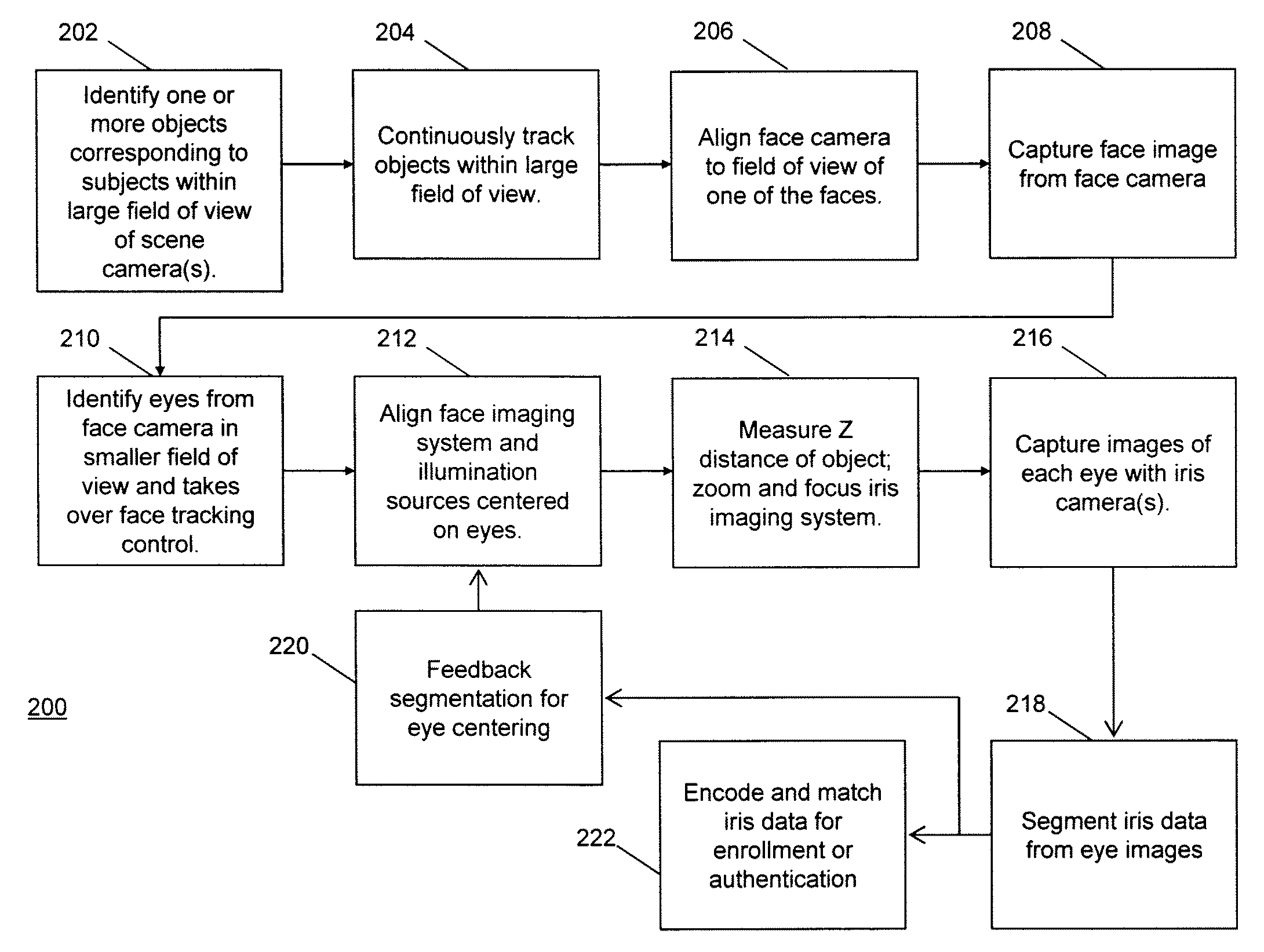

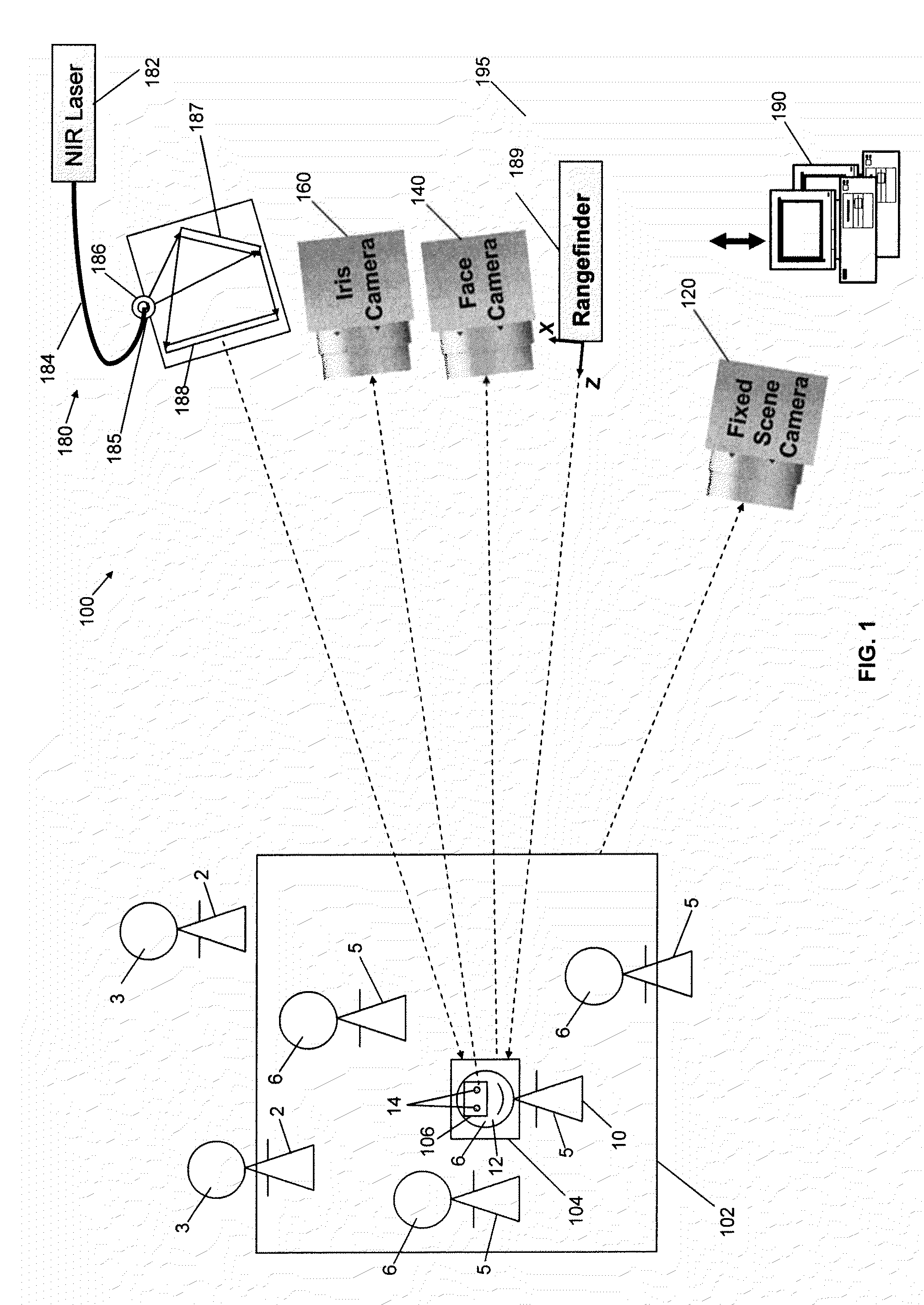

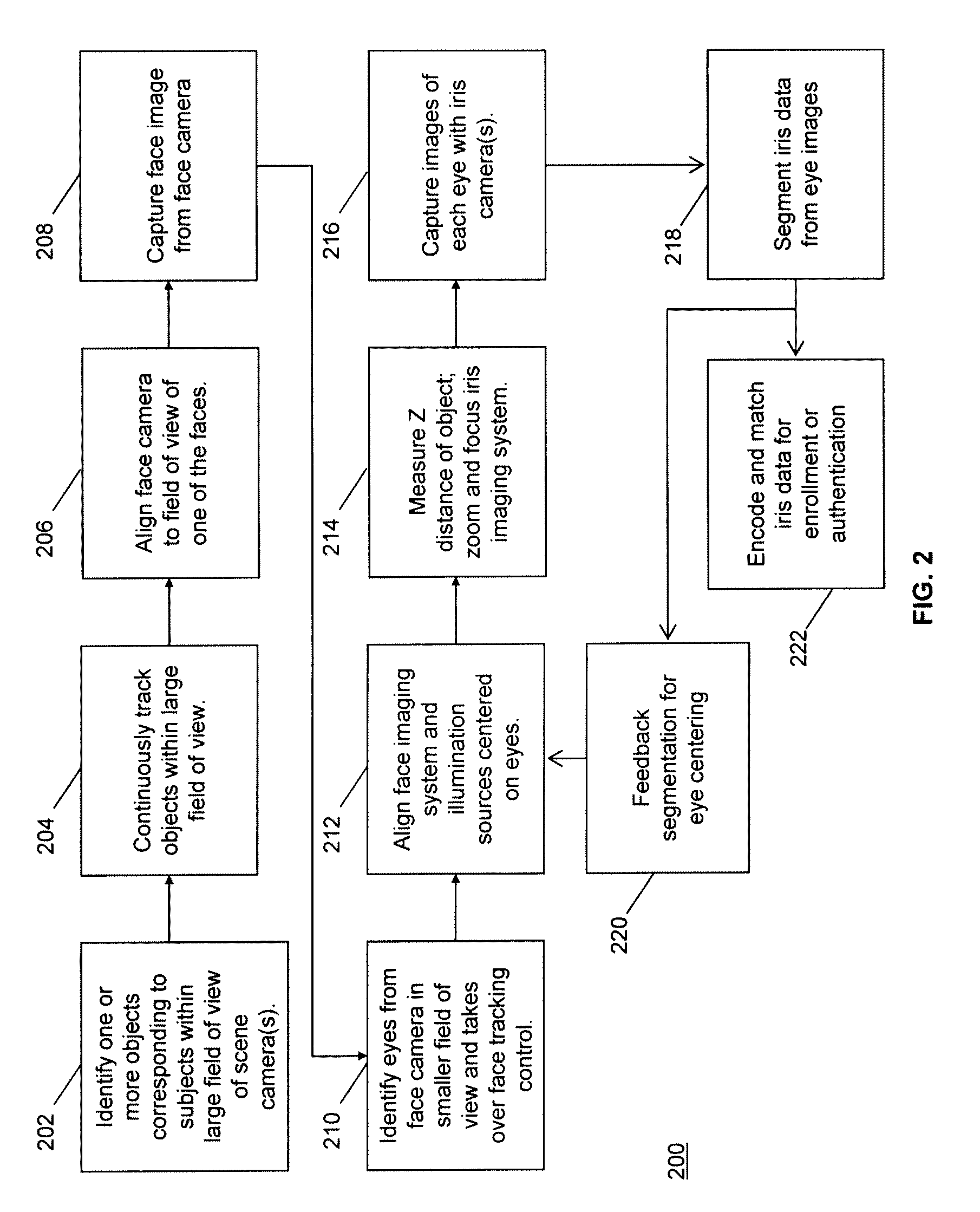

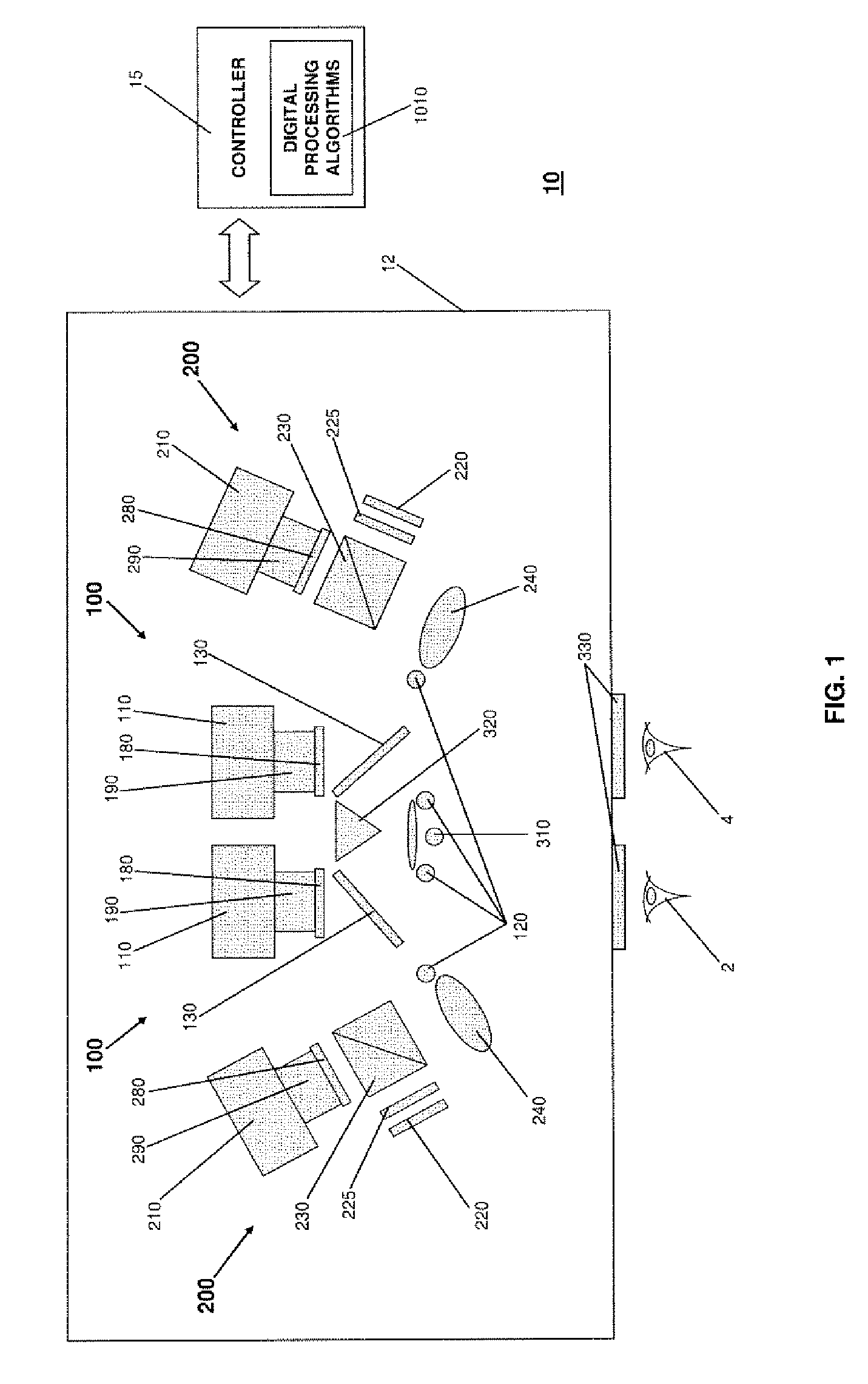

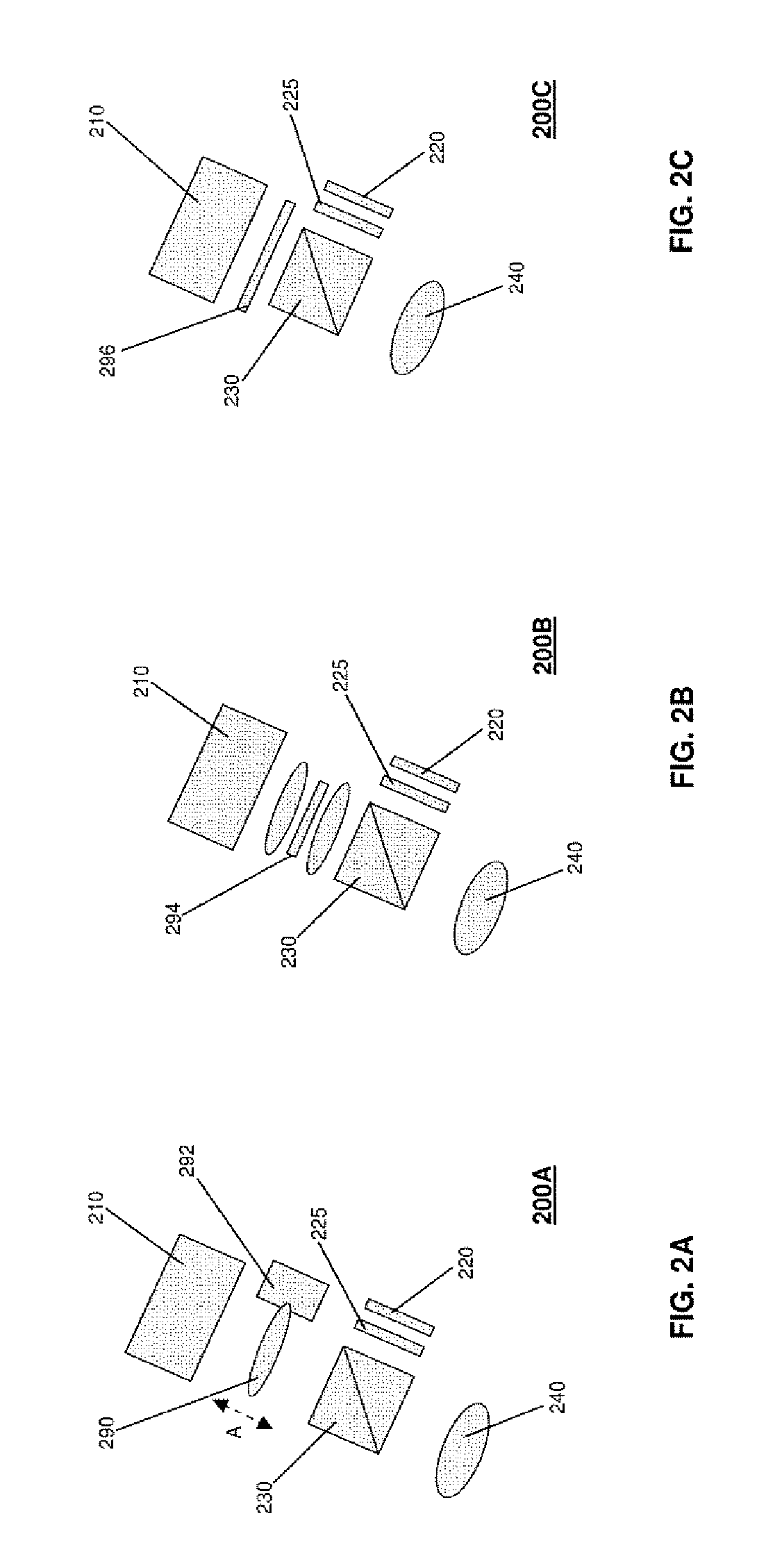

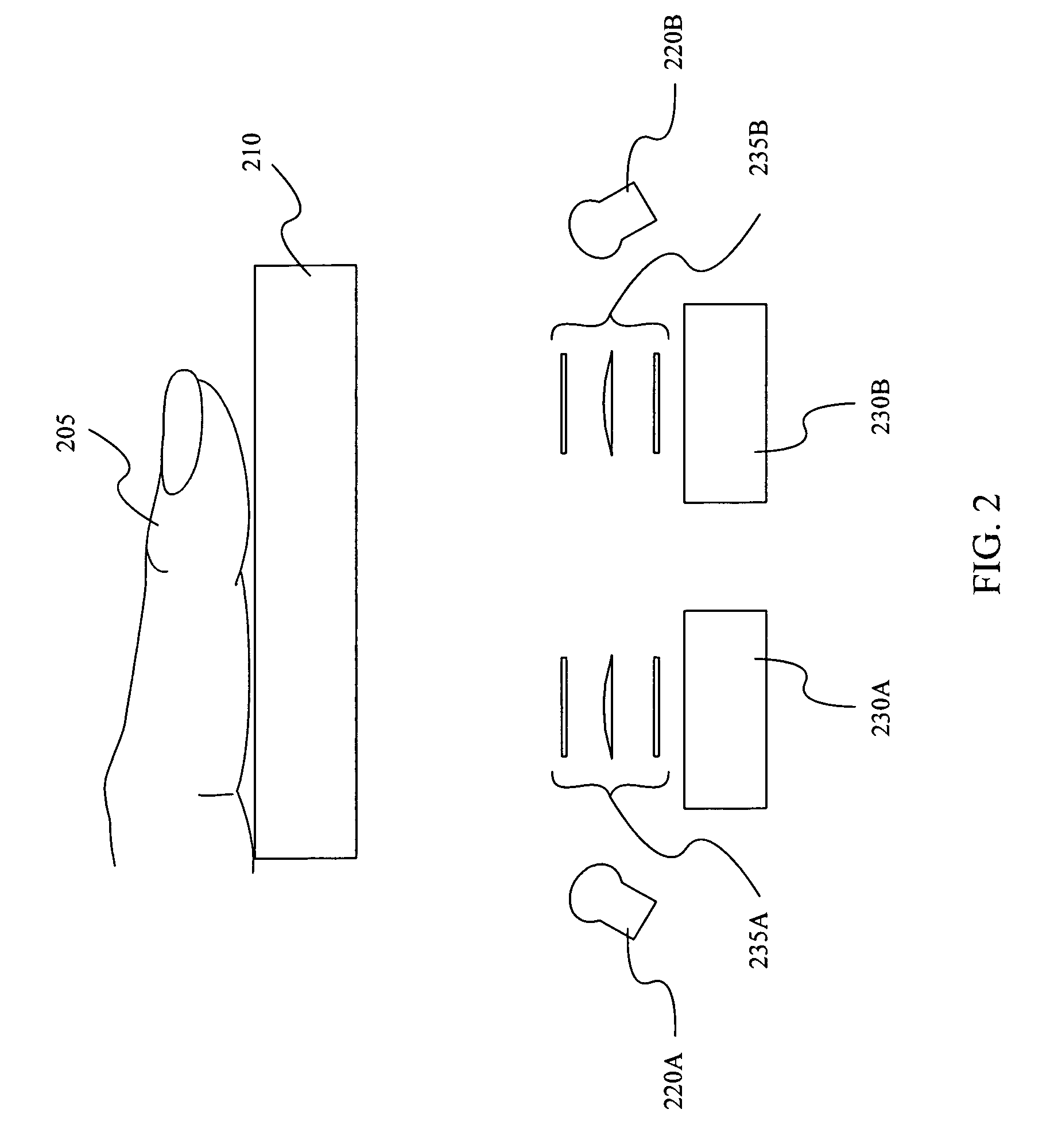

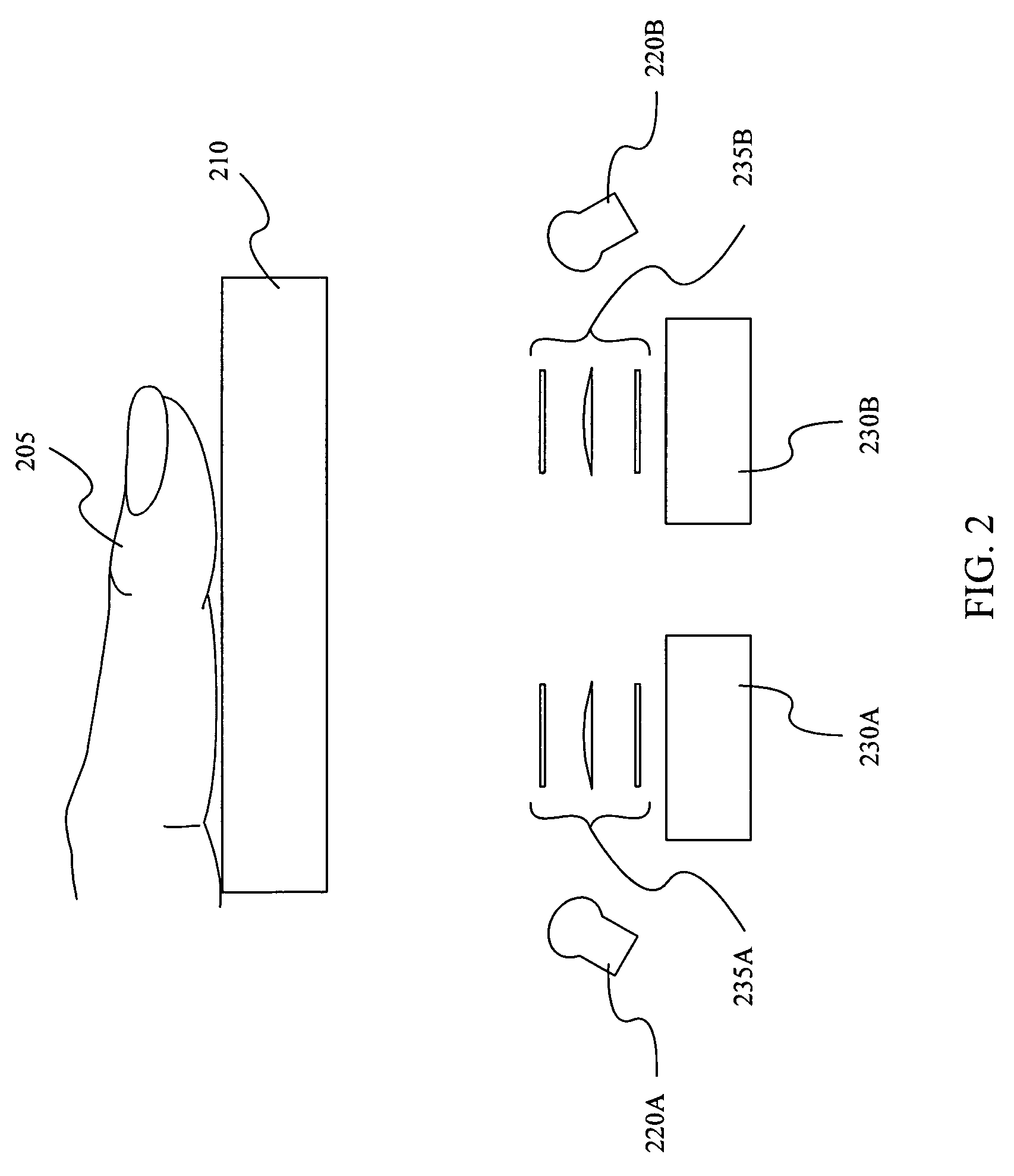

Long distance multimodal biometric system and method

InactiveUS20100290668A1Good compatibilityFew constraintsAcquiring/recognising eyesColor television detailsComputer scienceField of view

A system for multimodal biometric identification has a first imaging system that detects one or more subjects in a first field of view, including a targeted subject having a first biometric characteristic and a second biometric characteristic; a second imaging system that captures a first image of the first biometric characteristic according to first photons, where the first biometric characteristic is positioned in a second field of view smaller than the first field of view, and the first image includes first data for biometric identification; a third imaging system that captures a second image of the second biometric characteristic according to second photons, where the second biometric characteristic is positioned in a third field of view which is smaller than the first and second fields of view, and the second image includes second data for biometric identification. At least one active illumination source emits the second photons.

Owner:MORPHOTRUST USA

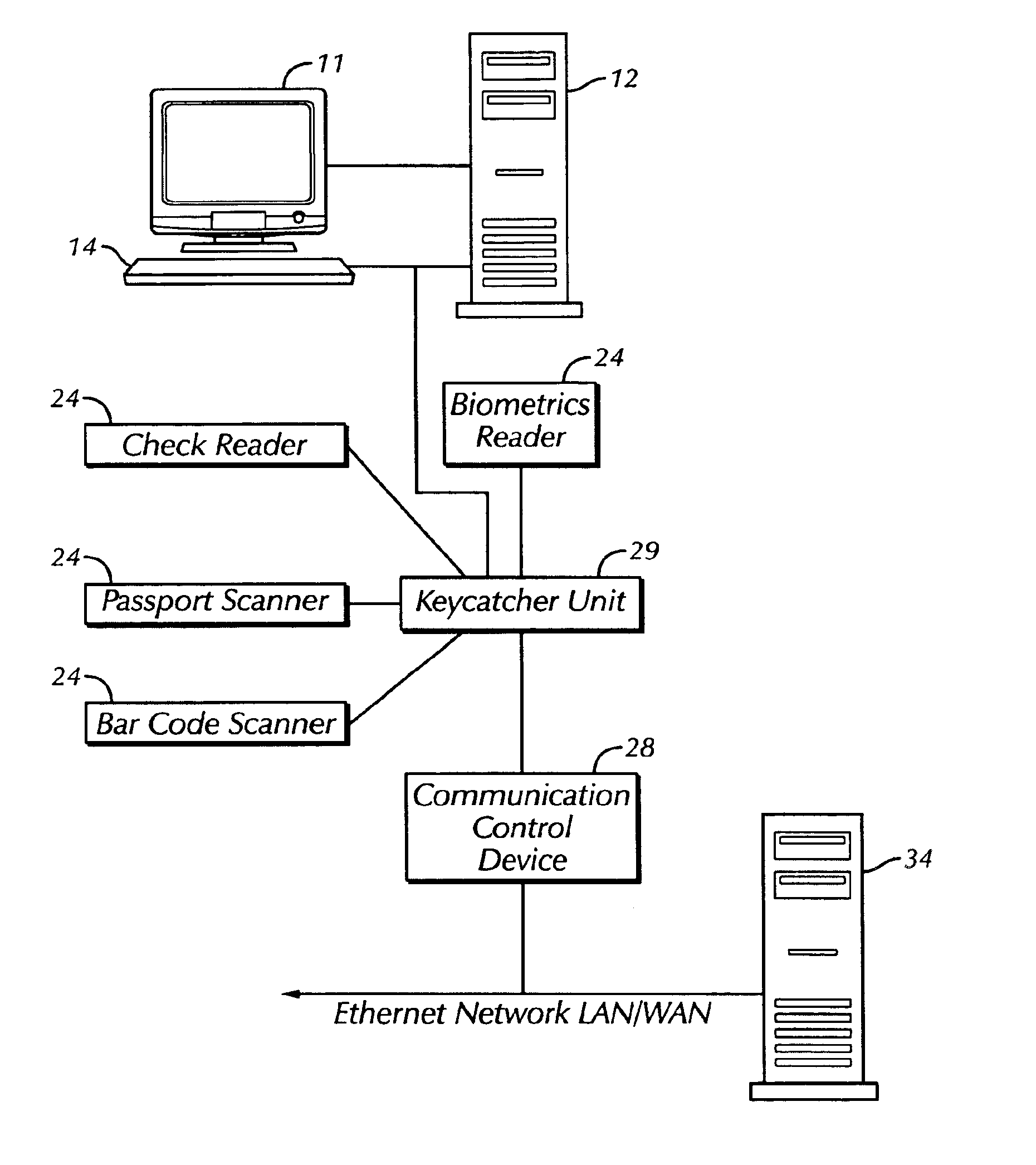

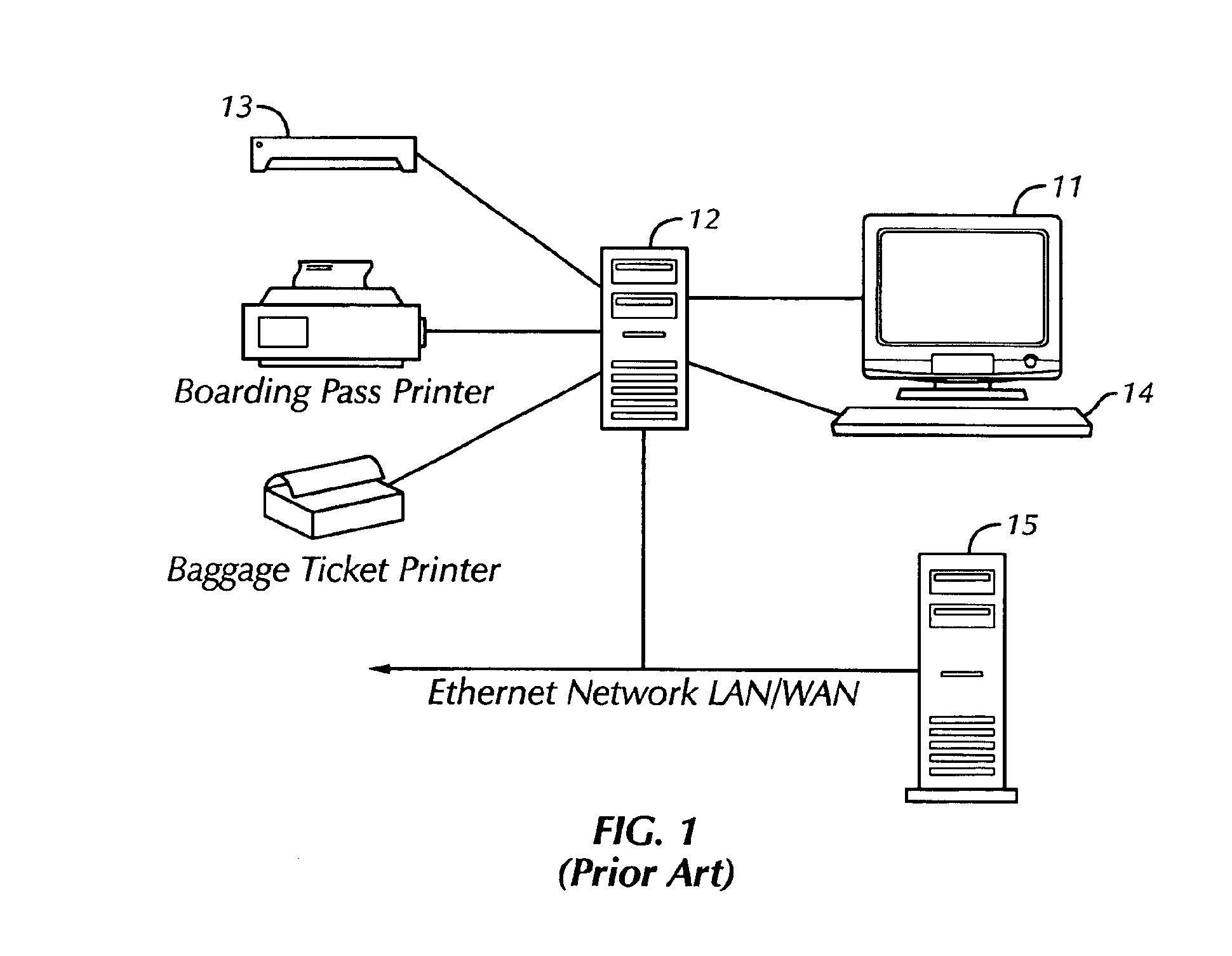

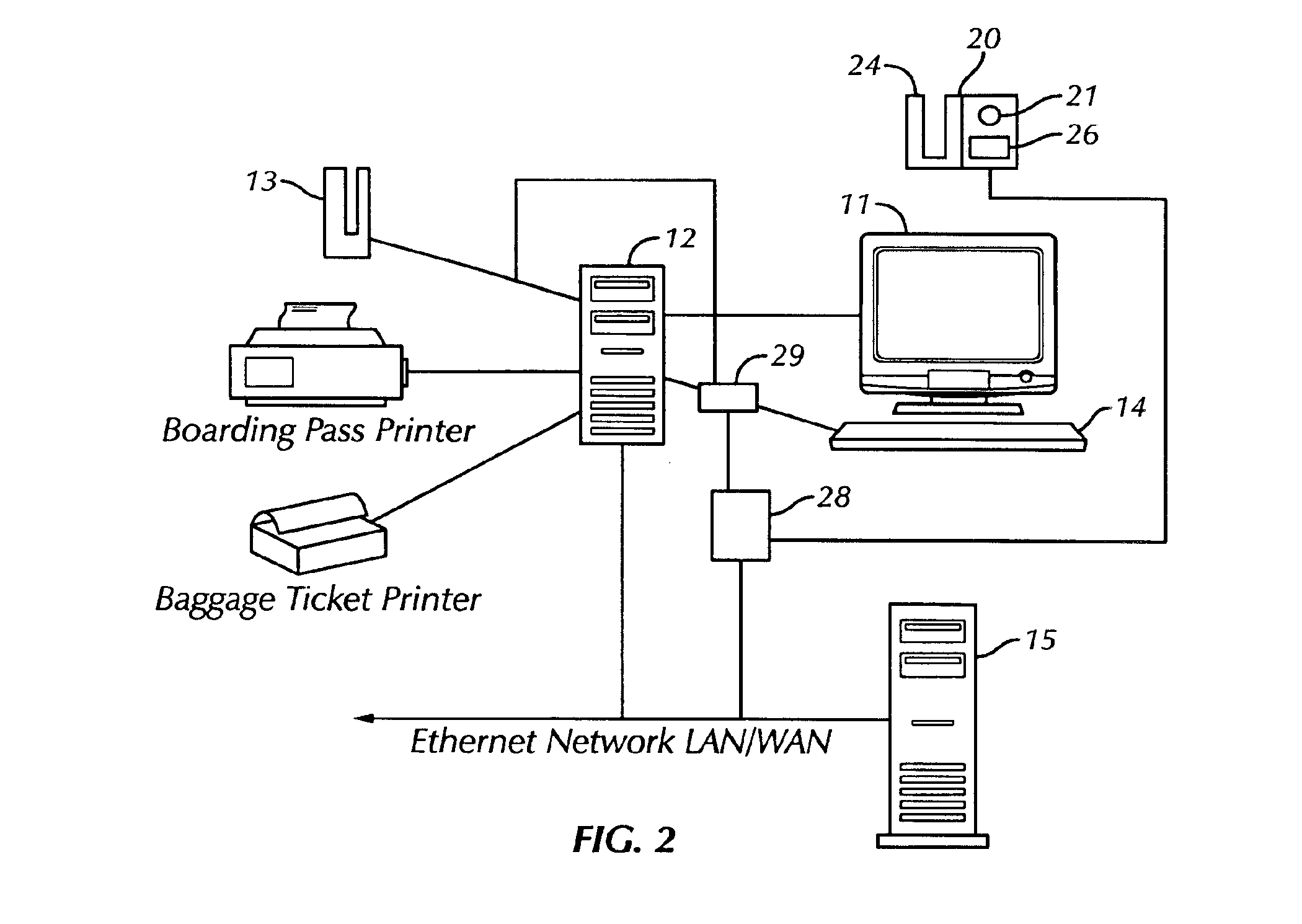

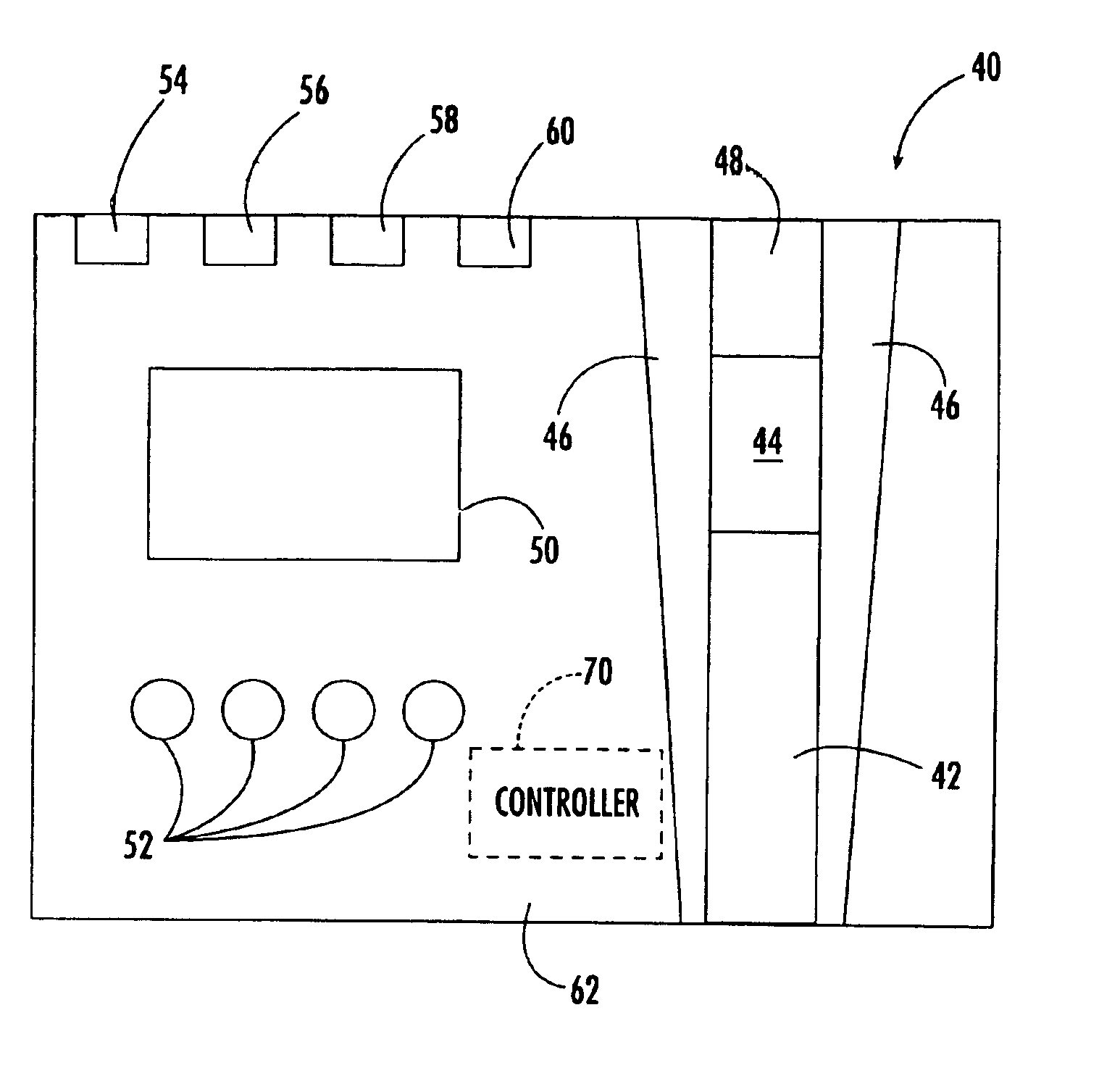

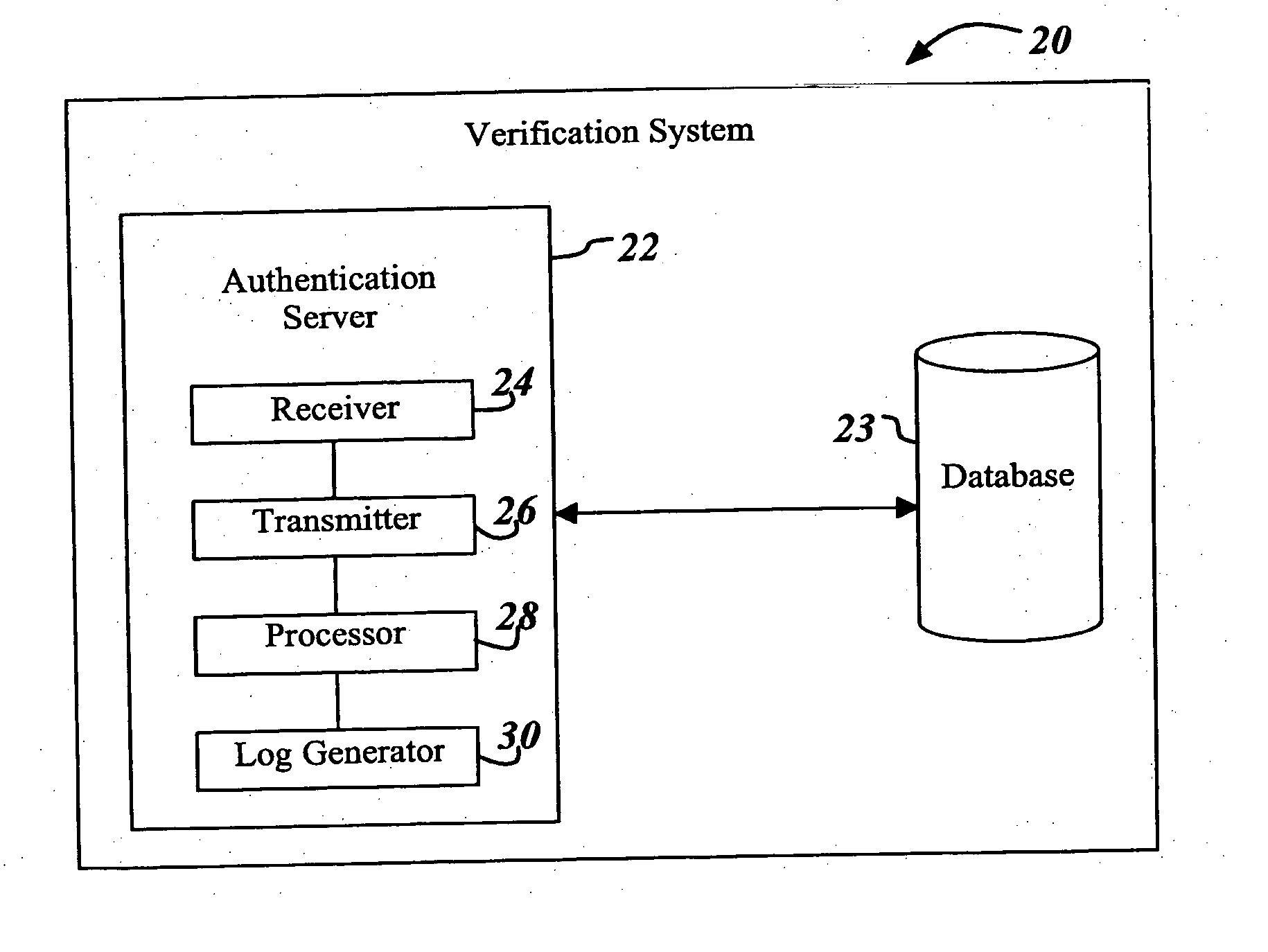

Identity verification system

The present invention is a security system that utilizes an identity verification system having a biometrics component, such as but not limited to a face, fingerprint, or iris recognition system. The system connects a biometric data entry device such as a standard analogue or digital camera to a communication control device which captures, compresses and digitizes the biometric data as well as converts data from data input devices and sends the compressed and digitized biometric data along with the data from a data input device to a central processing unit for processing by a biometric recognition system and comparison to stored biometric data.

Owner:BIOCOM

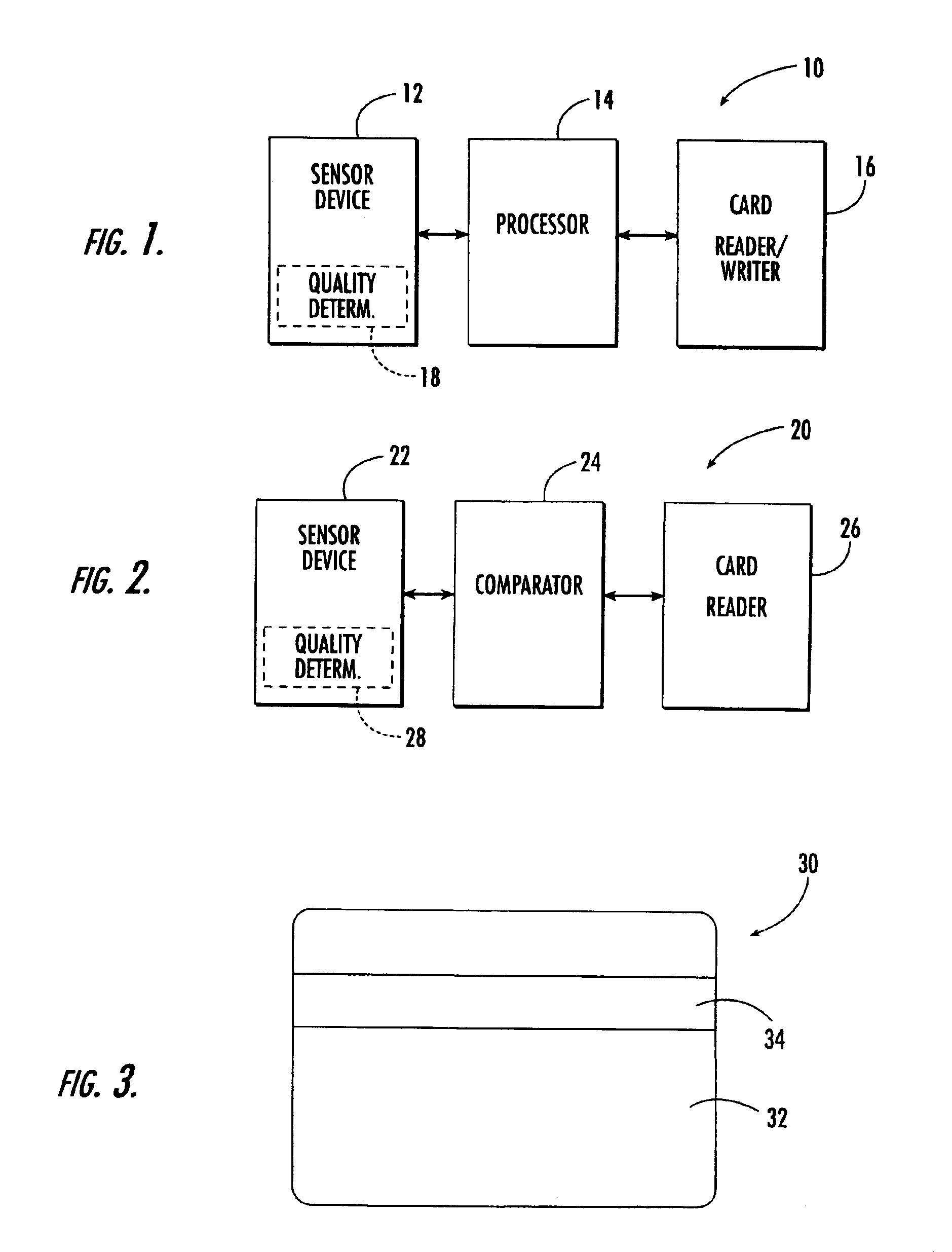

Biometric identification system using biometric images and personal identification number stored on a magnetic stripe and associated methods

InactiveUS6959874B2Digital data authenticationBiometric pattern recognitionPersonal identification numberBiometric data

The system and method store biometric information and a personal identification number (PIN) on a token having a magnetic storage medium. A biometric image is captured, biometric data is produced and a PIN is provided by an authorized user. The biometric data and PIN are stored on the magnetic storage medium of the token for subsequent use in verifying an authorized user of the token.

Owner:III HLDG 1

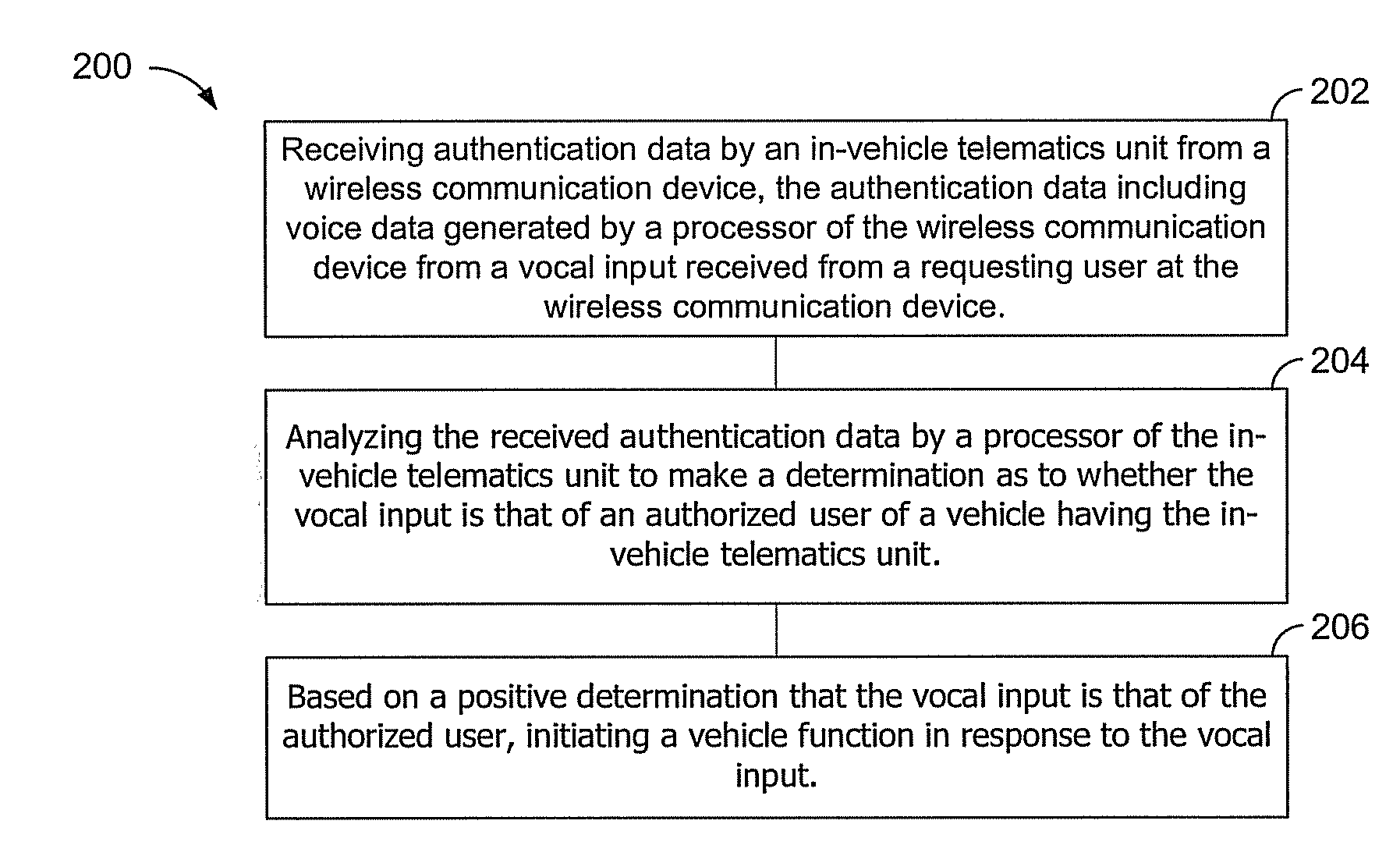

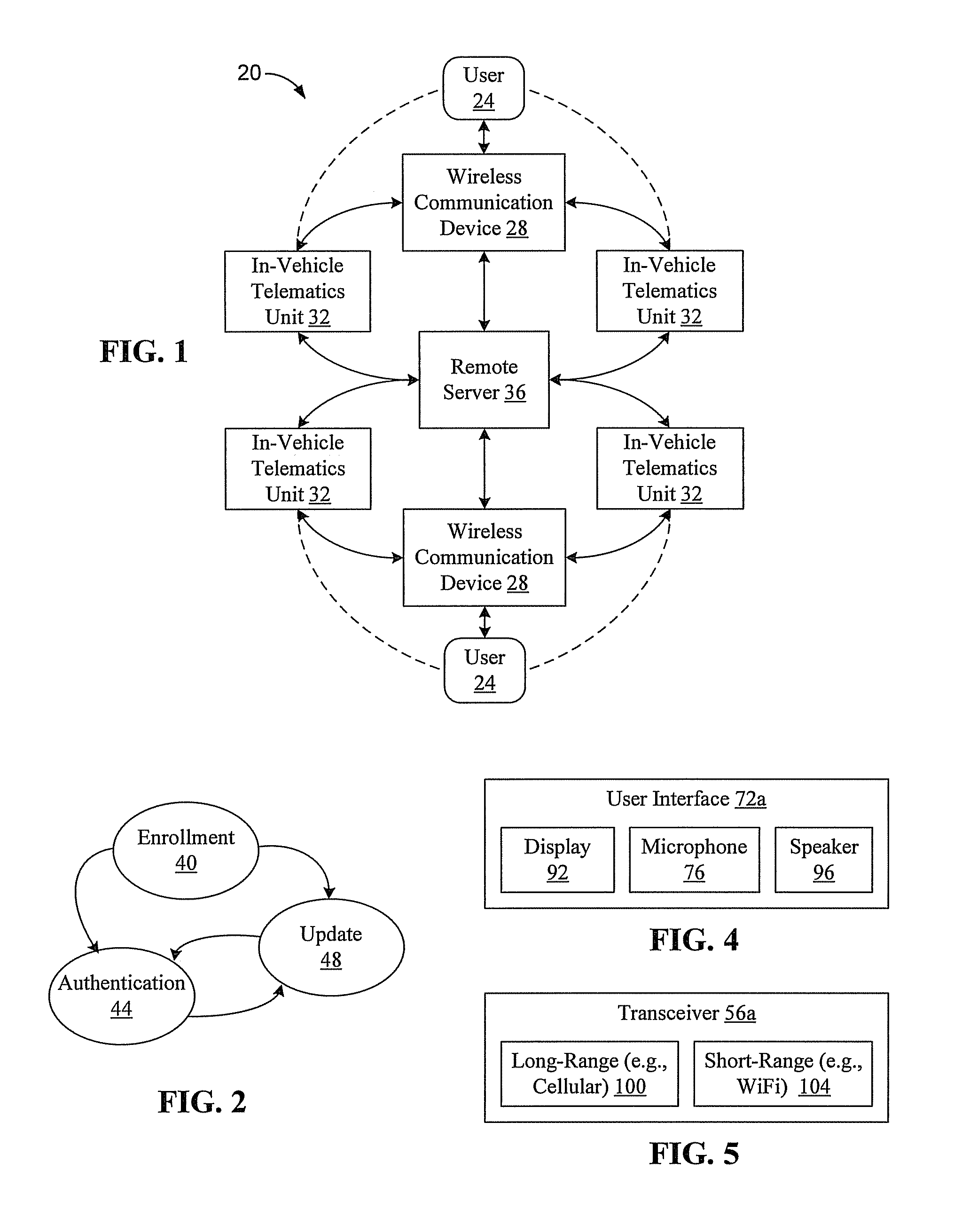

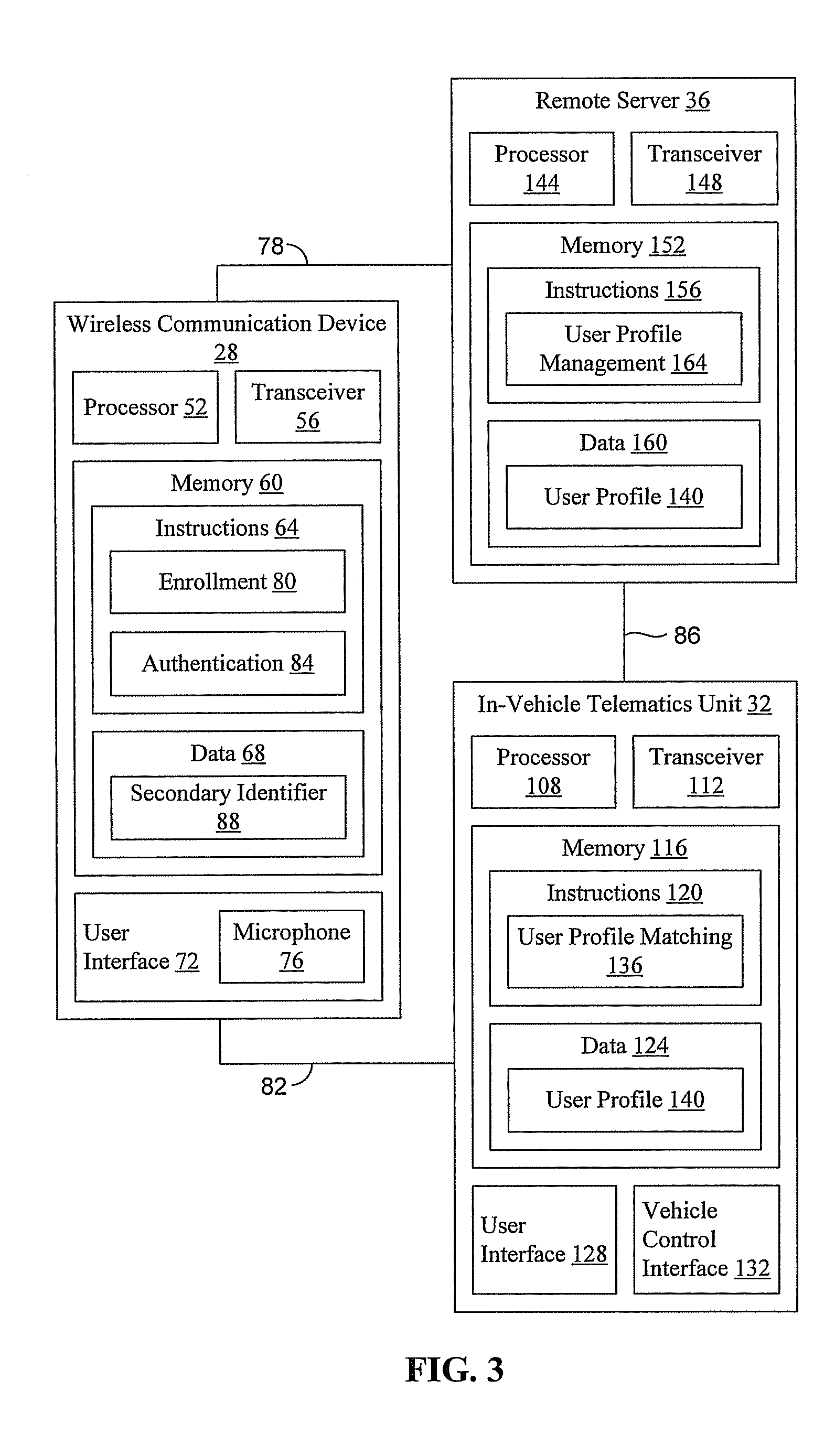

Vehicle biometric systems and methods

InactiveUS20100097178A1Electric signal transmission systemsDigital data processing detailsIn vehicleSpeech input

A vehicle biometric system includes an in-vehicle telematics unit having a receiver configured to receive authentication data from a wireless communication device, a memory configured to store computer program instructions, and a processor configured to access and execute the computer program instructions. The authentication data can include voice data based on a vocal input received at the wireless communication device from a requesting user. The executed computer program instructions can cause the processor to analyze the received authentication data to make a determination as to whether the vocal input is that of an authorized user of the vehicle, and based on a positive determination that the vocal input is that of the authorized user, to initiate a vehicle function in response to the vocal input.

Owner:TOYOTA MOTOR SALES USA

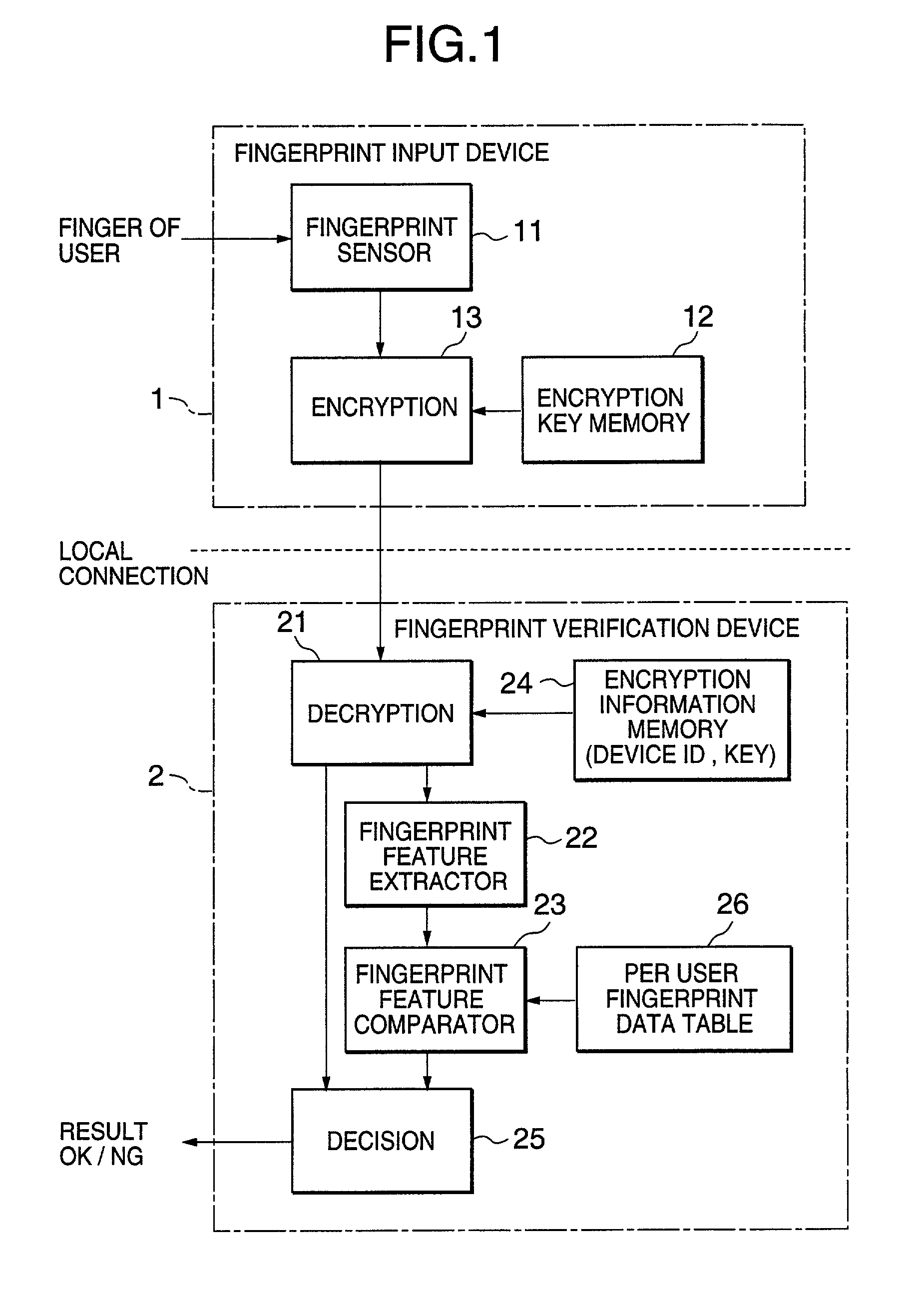

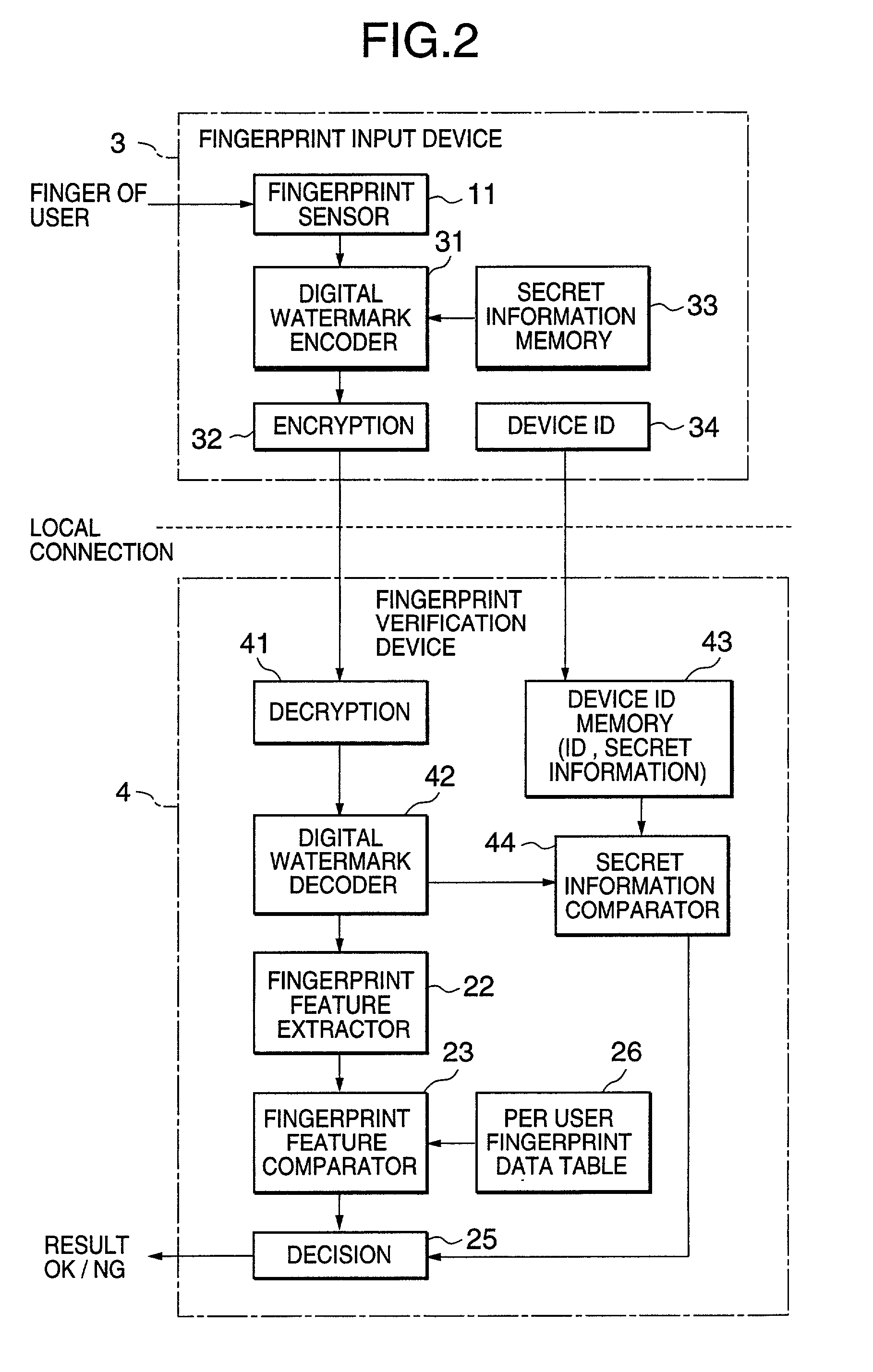

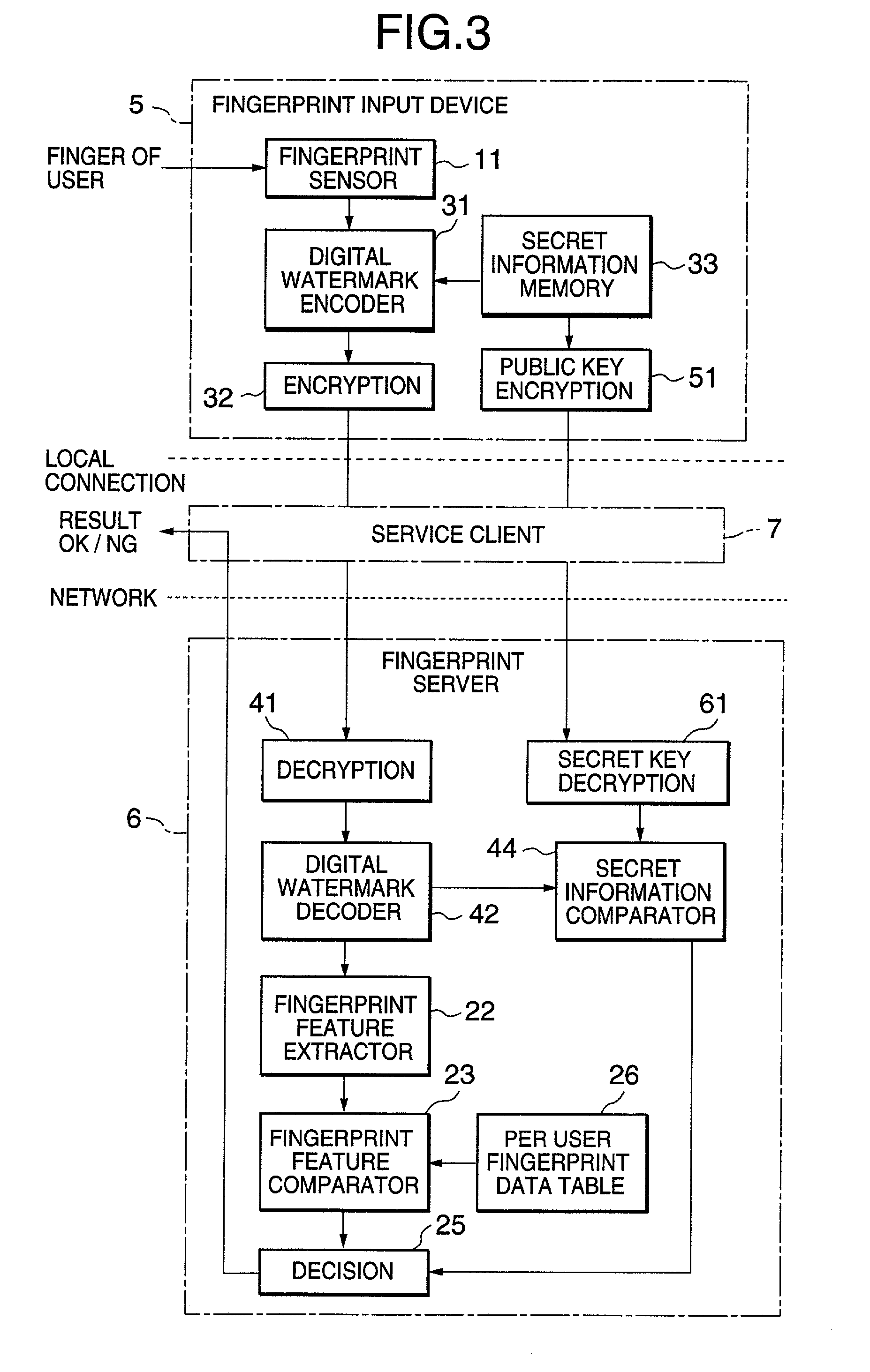

Biometric identification method and system

InactiveUS20010025342A1Reliable identificationDigital data processing detailsUser identity/authority verificationBiometric dataBiometric system

Owner:NEC CORP

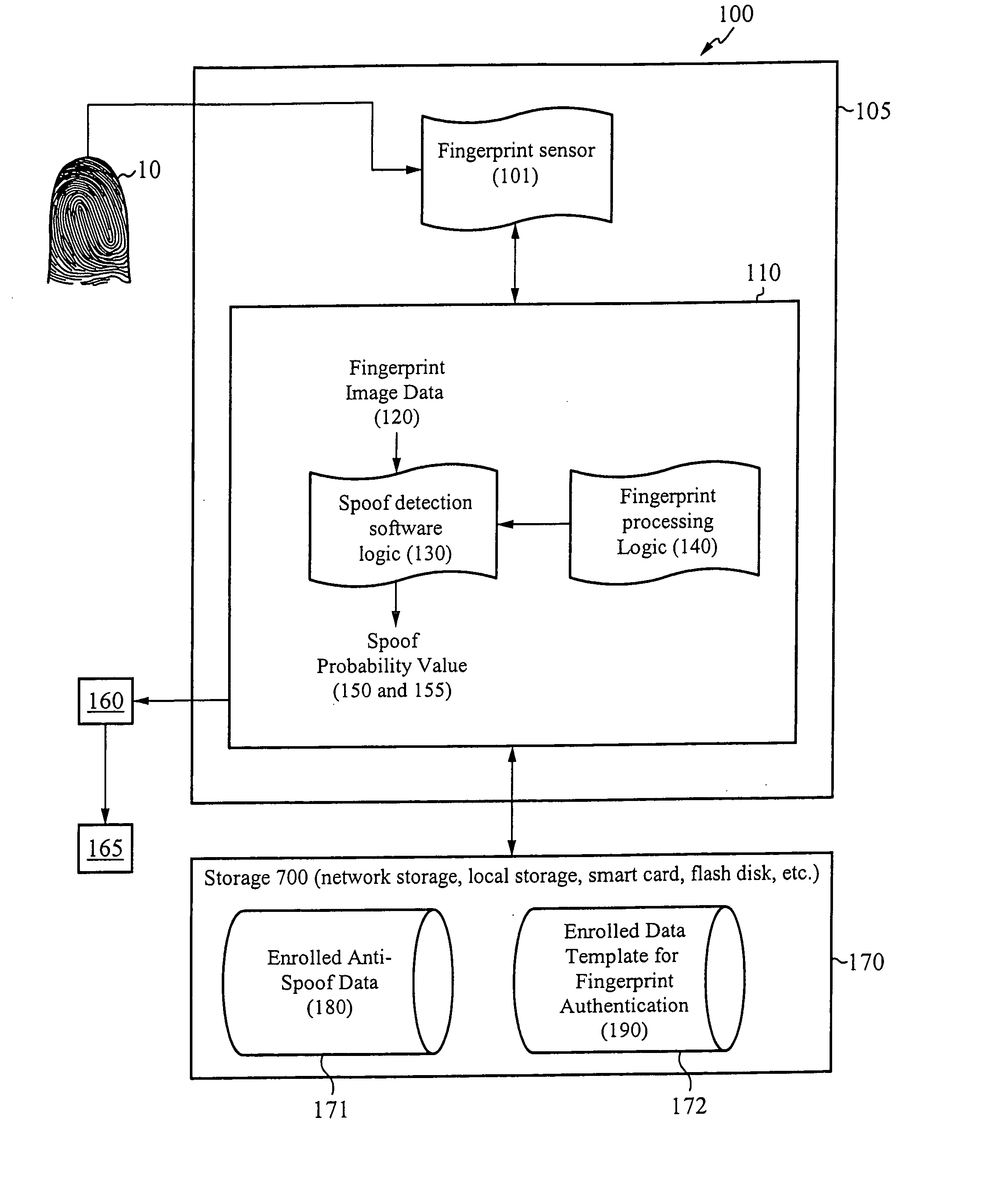

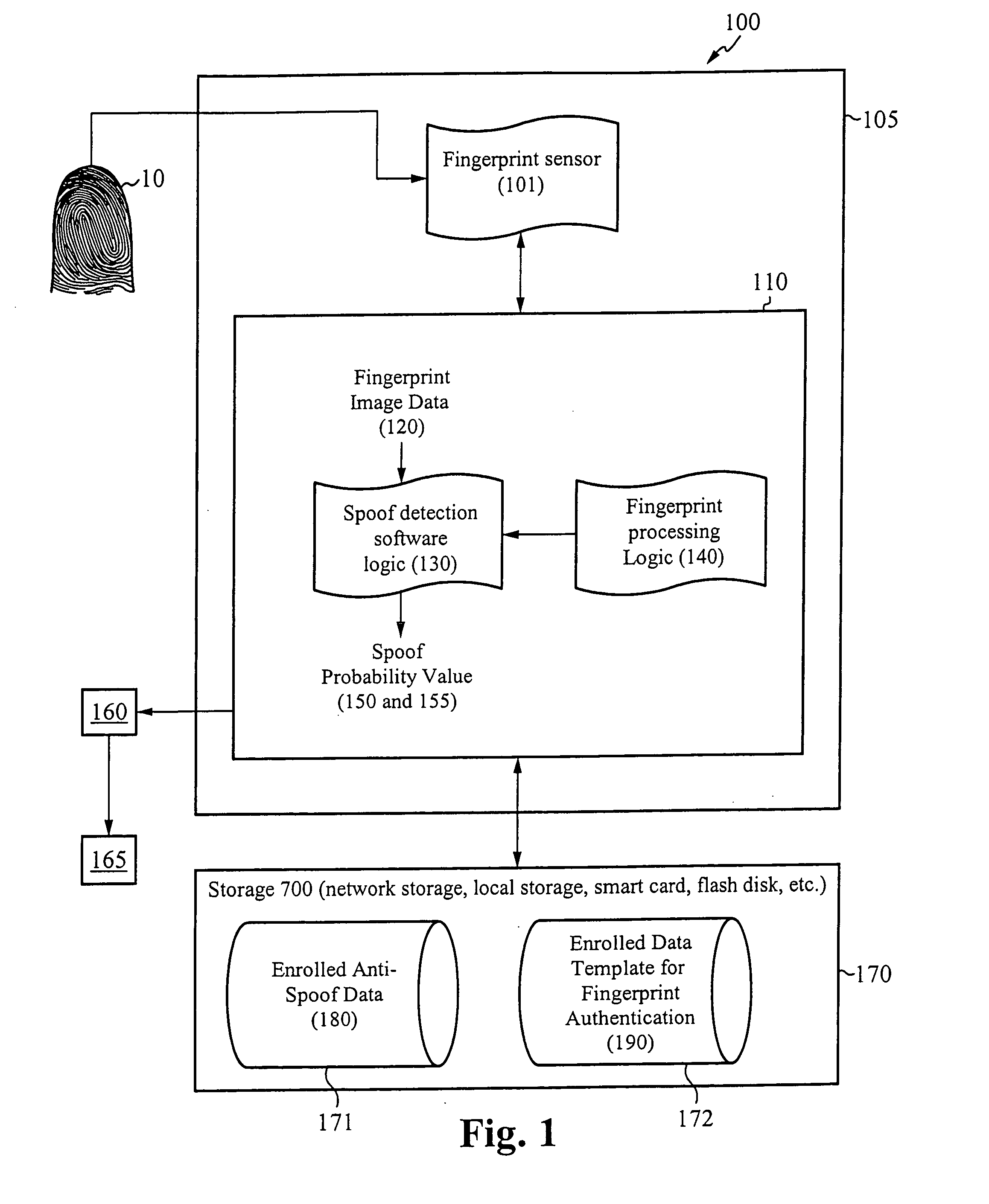

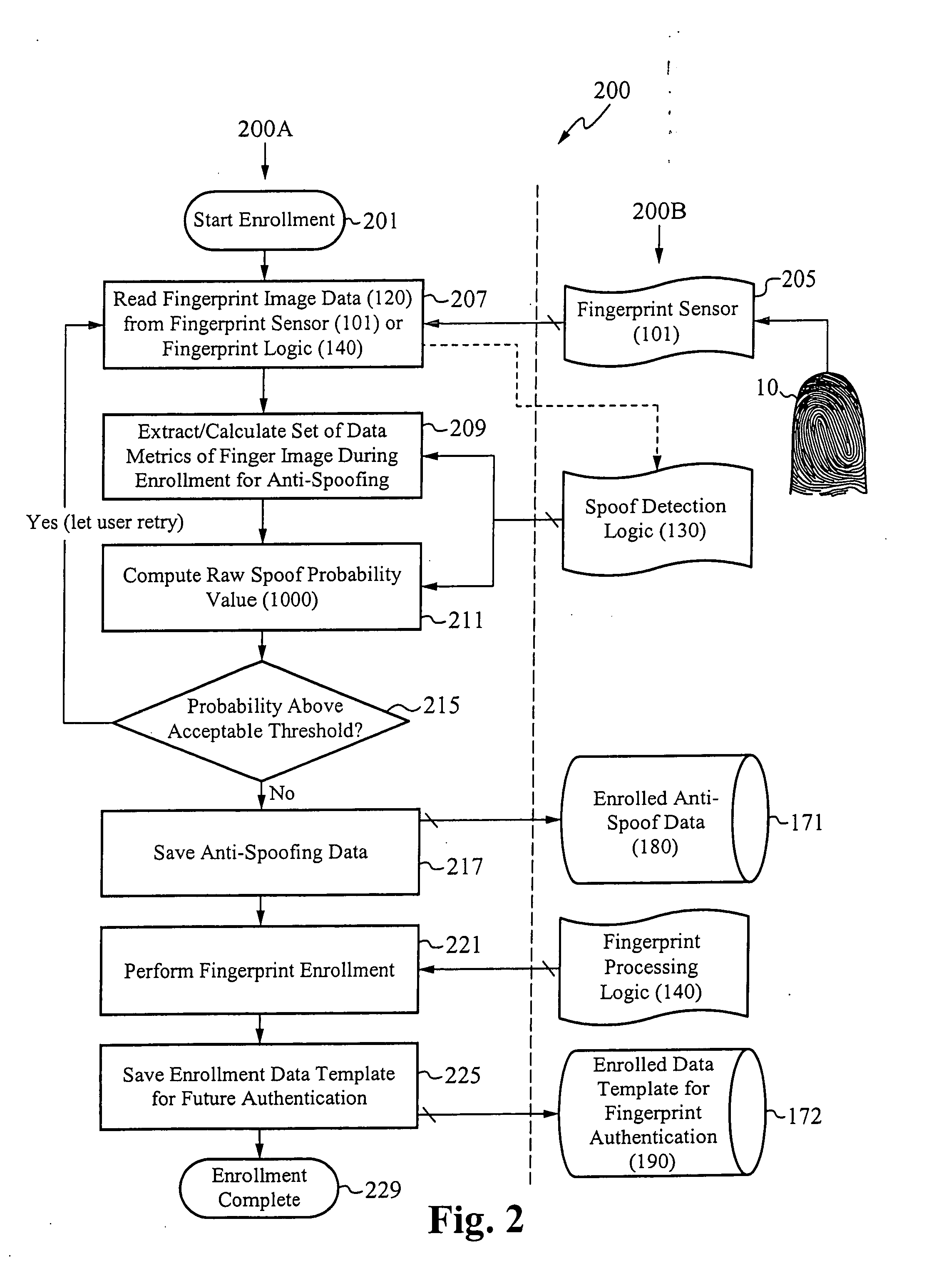

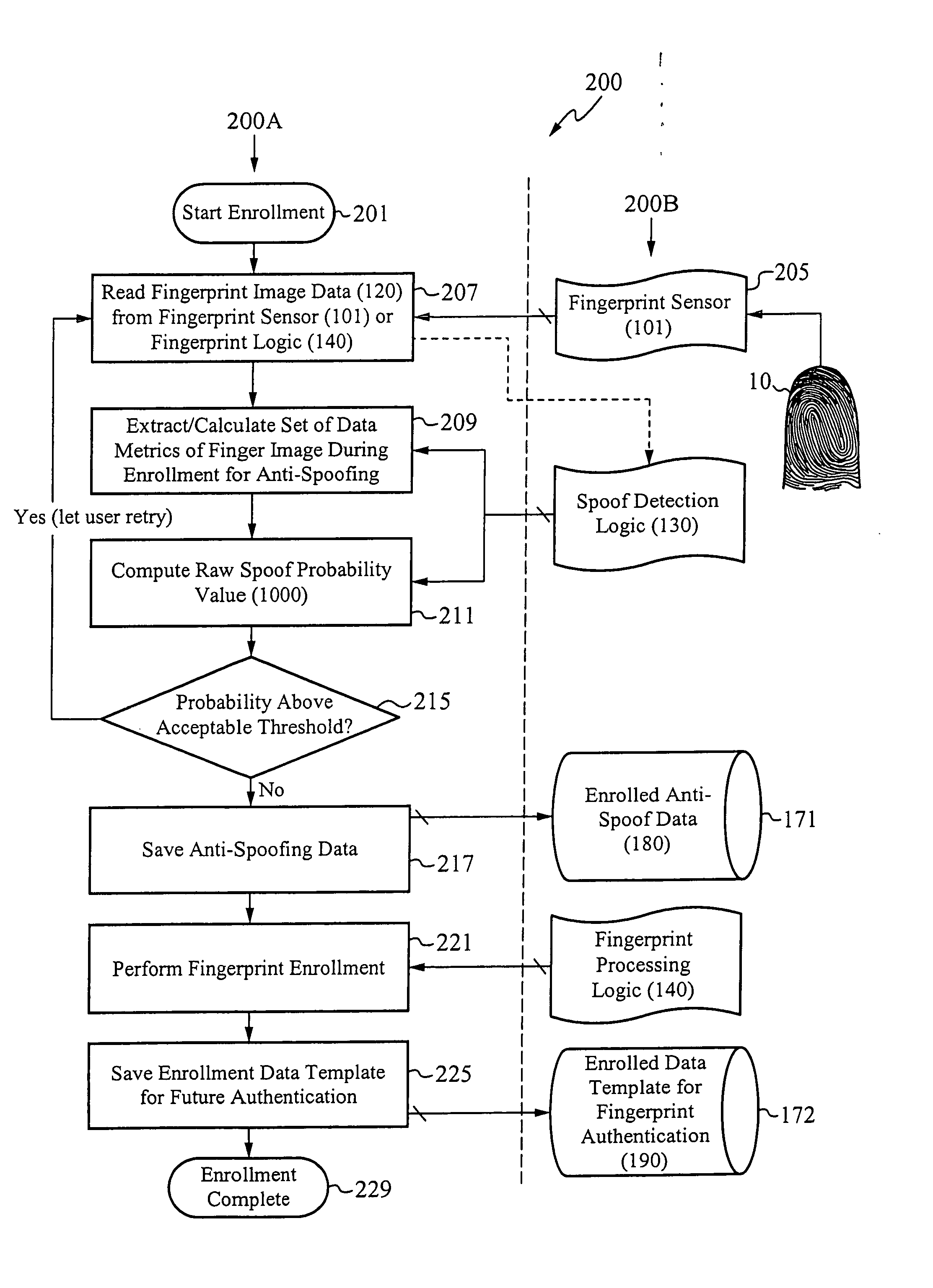

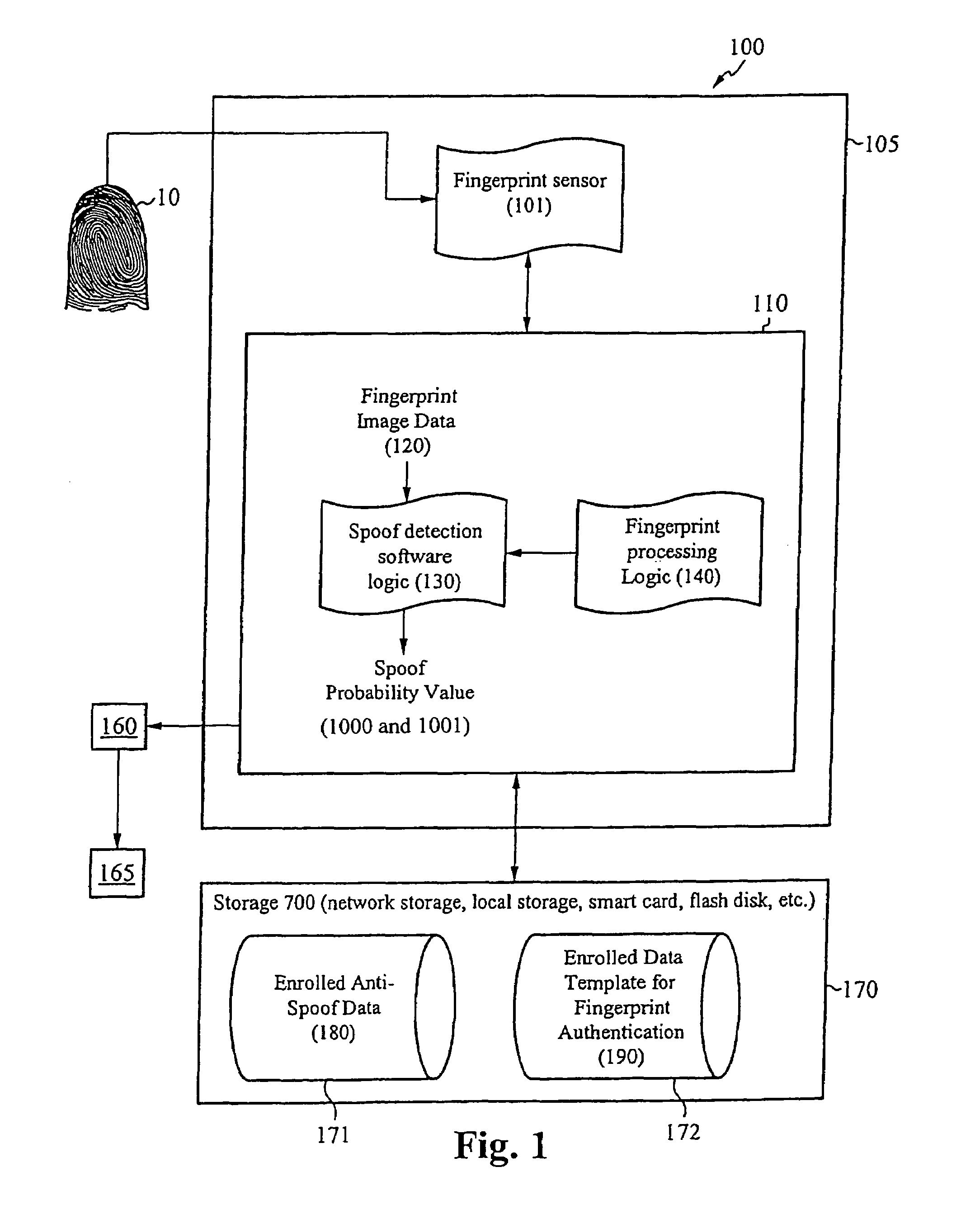

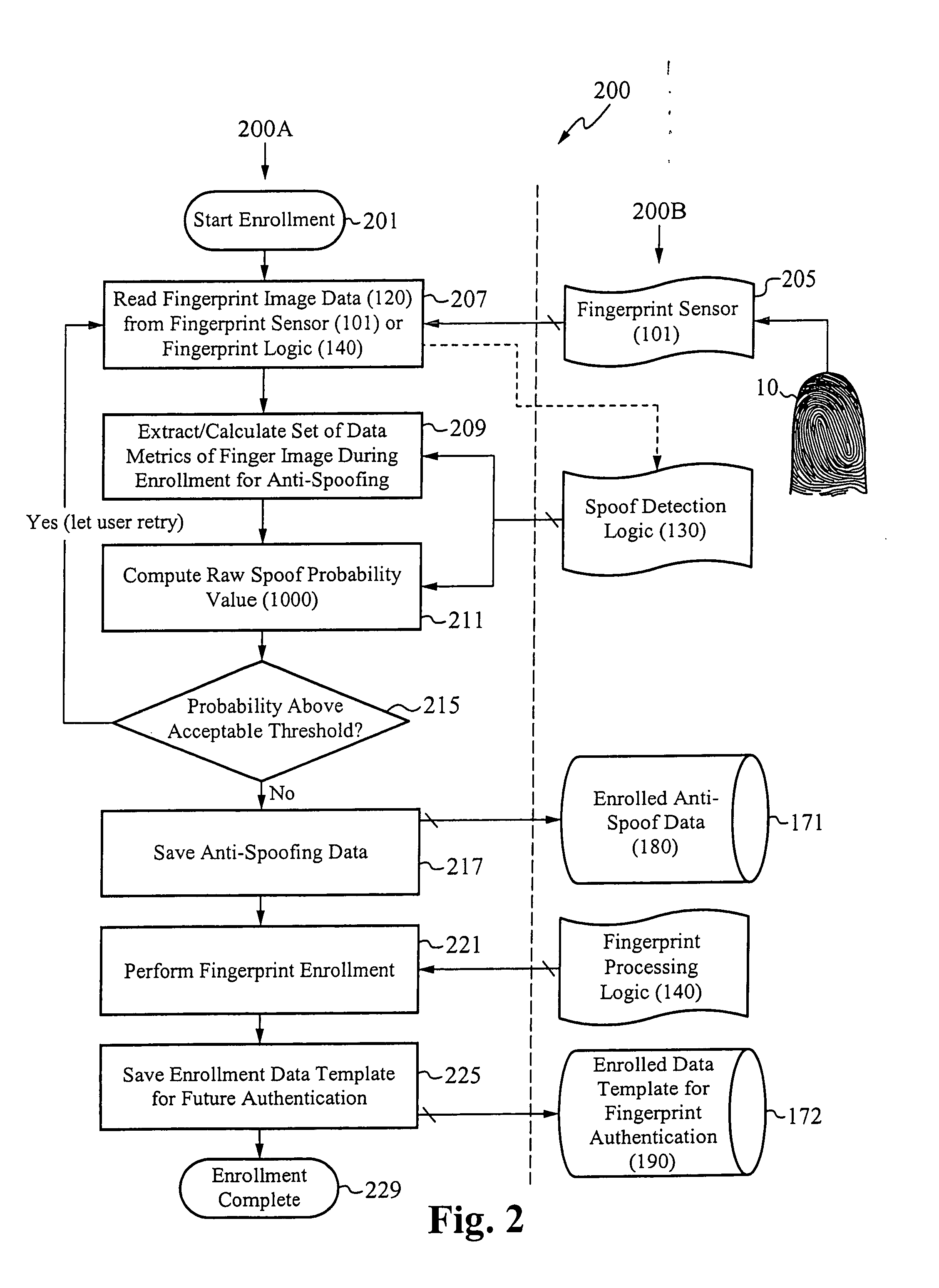

System for and method of securing fingerprint biometric systems against fake-finger spoofing

ActiveUS20070014443A1Easy to predictElectric signal transmission systemsImage analysisPattern recognitionGray level

A biometric secured system grants a user access to a host system by classifying a fingerprint used to verify or authorize the user to the system as real or fake. The classification is based on a probability that fingerprint image data corresponds to characteristics that reliably identify the finger as real. The system includes a fingerprint sensor for capturing fingerprint image data coupled to a spoof detection module. In one embodiment, the spoof detection module is programmed to determine spoof probability based on a combination of metrics that include, among other metrics, pixel gray level average and the variance of pixels corresponding to a fingerprint ridge, pixel gray level average and the variance of pixels corresponding to a fingerprint valley, density of sweat pores, and density of sweat streaks, to name a few metrics.

Owner:APPLE INC

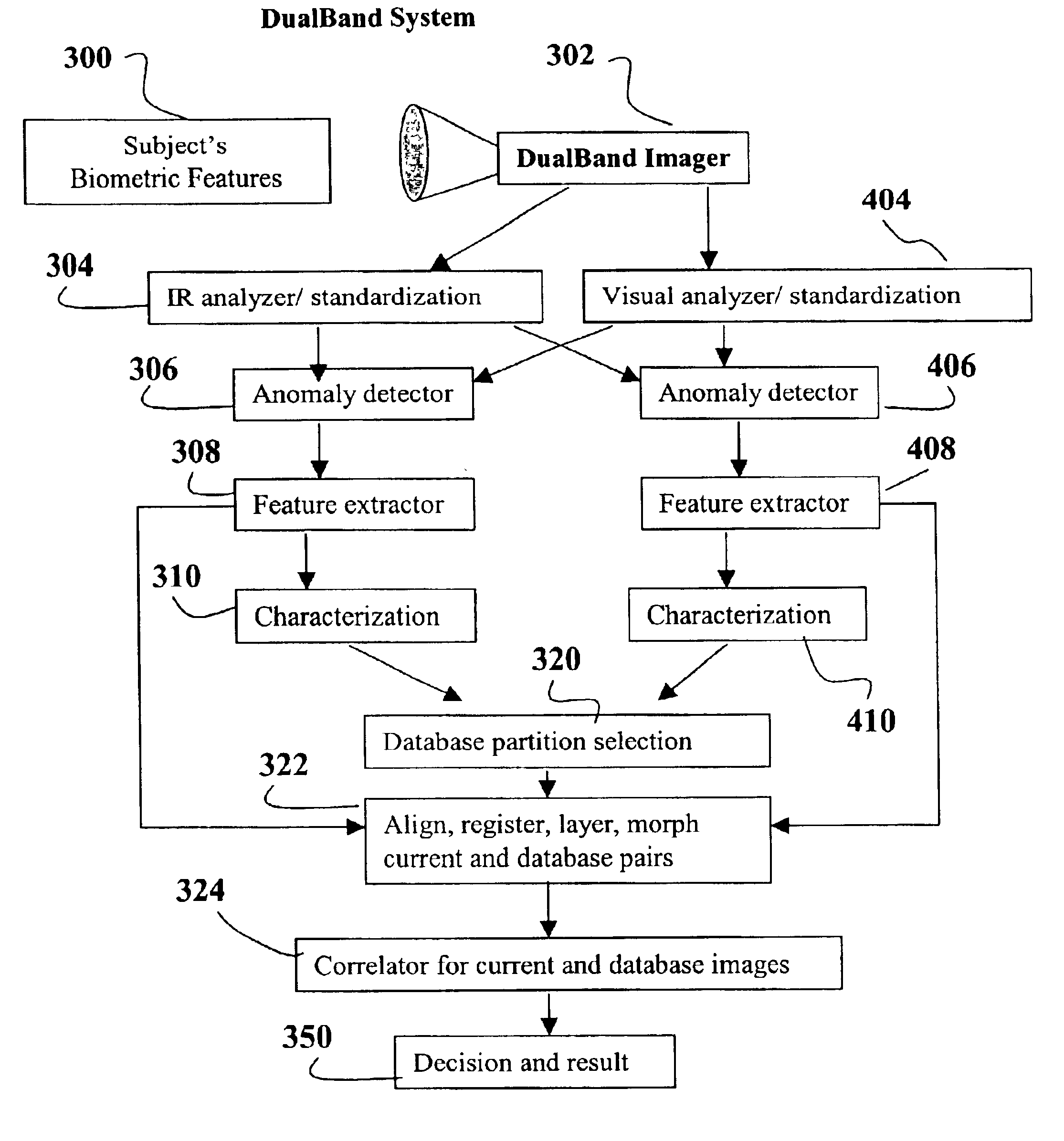

Dual band biometric identification system

InactiveUS6920236B2Improve accuracyRaise the possibilitySpoof detectionSubcutaneous biometric featuresVirtual cameraVisual perception

Owner:MIKOS

System for and method of securing fingerprint biometric systems against fake-finger spoofing

ActiveUS7505613B2Easy to predictElectric signal transmission systemsImage analysisPattern recognitionGray level

A biometric secured system grants a user access to a host system by classifying a fingerprint used to verify or authorize the user to the system as real or fake. The classification is based on a probability that fingerprint image data corresponds to characteristics that reliably identify the finger as real. The system includes a fingerprint sensor for capturing fingerprint image data coupled to a spoof detection module. In one embodiment, the spoof detection module is programmed to determine spoof probability based on a combination of metrics that include, among other metrics, pixel gray level average and the variance of pixels corresponding to a fingerprint ridge, pixel gray level average and the variance of pixels corresponding to a fingerprint valley, density of sweat pores, and density of sweat streaks, to name a few metrics.

Owner:APPLE INC

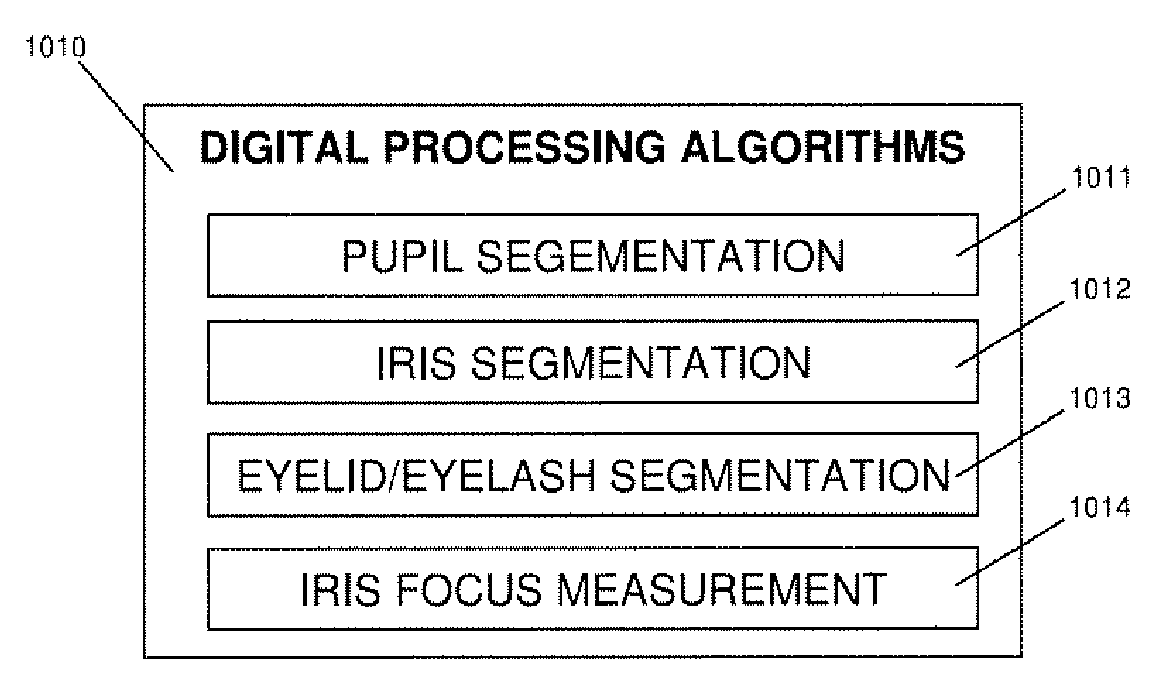

Multimodal ocular biometric system and methods

ActiveUS20080253622A1Easy to operatePrecise positioningImage enhancementImage analysisEyelidBiometric data

Biometric systems capture and combine biometric information from more than one modality, employing digital processing algorithms to process and evaluate captured images having data for a biometric characteristic. Such digital algorithms may include a pupil segmentation algorithm for determining a pupil image in the captured image, an iris segmentation algorithm for determining an iris image in the captured image, an eyelid / eyelash segmentation algorithm for determining an eyelid / eyelash image in the captured image, and an algorithm for measuring the focus on the iris. Some embodiments employ an auto-capture process which employs such algorithms, in part, to evaluate captured images and obtain the best possible images for biometric identification.

Owner:MORPHOTRUST USA

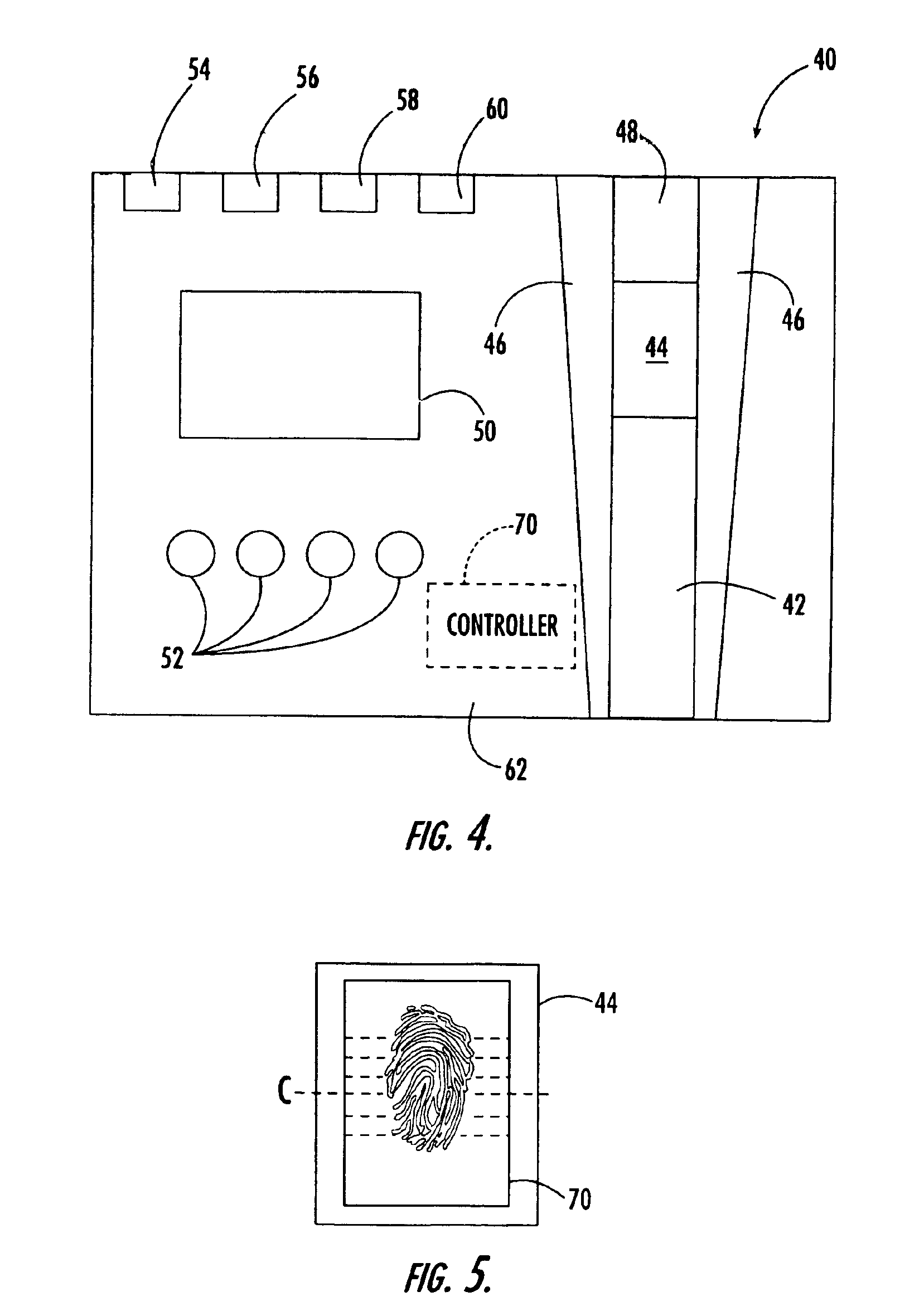

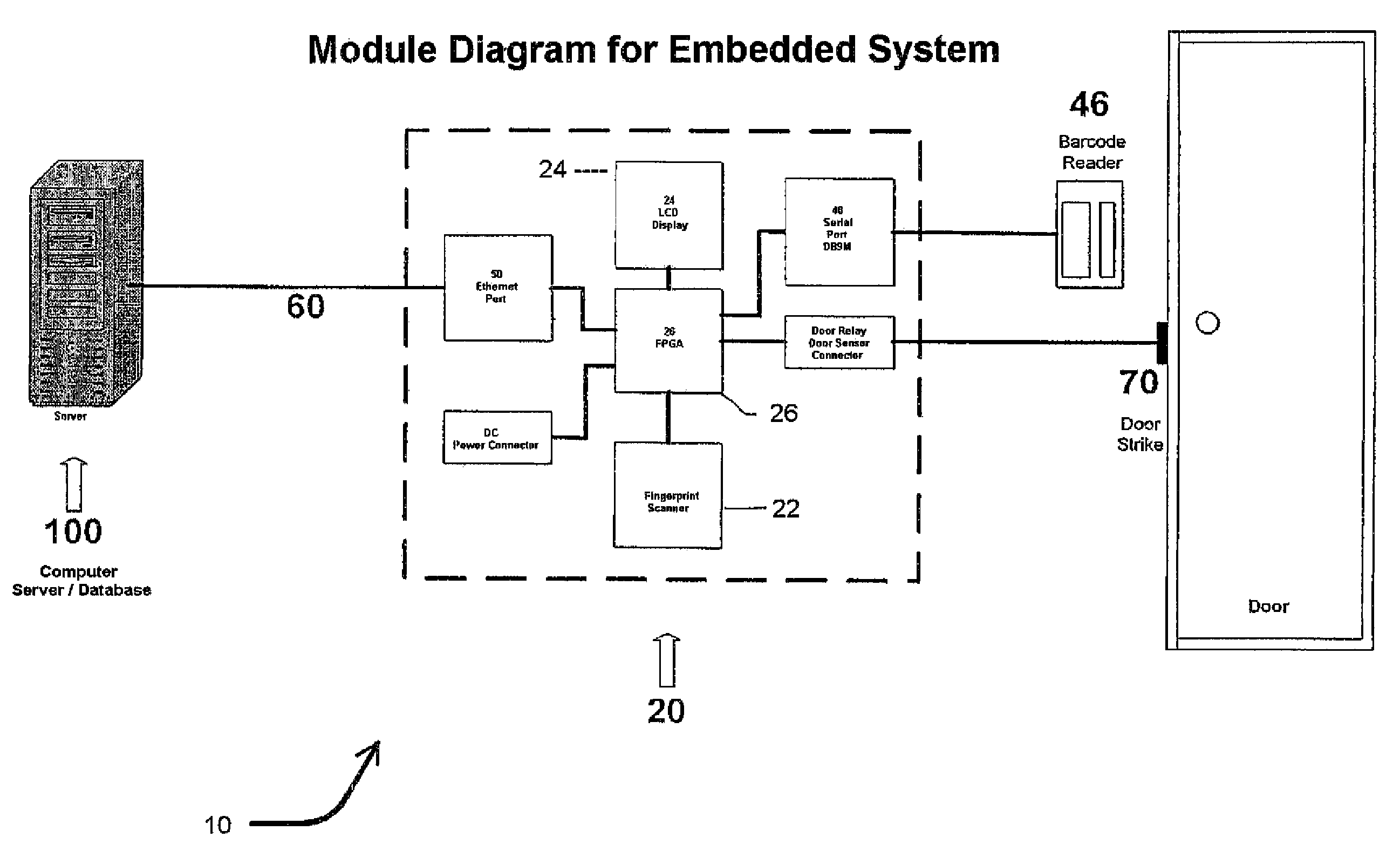

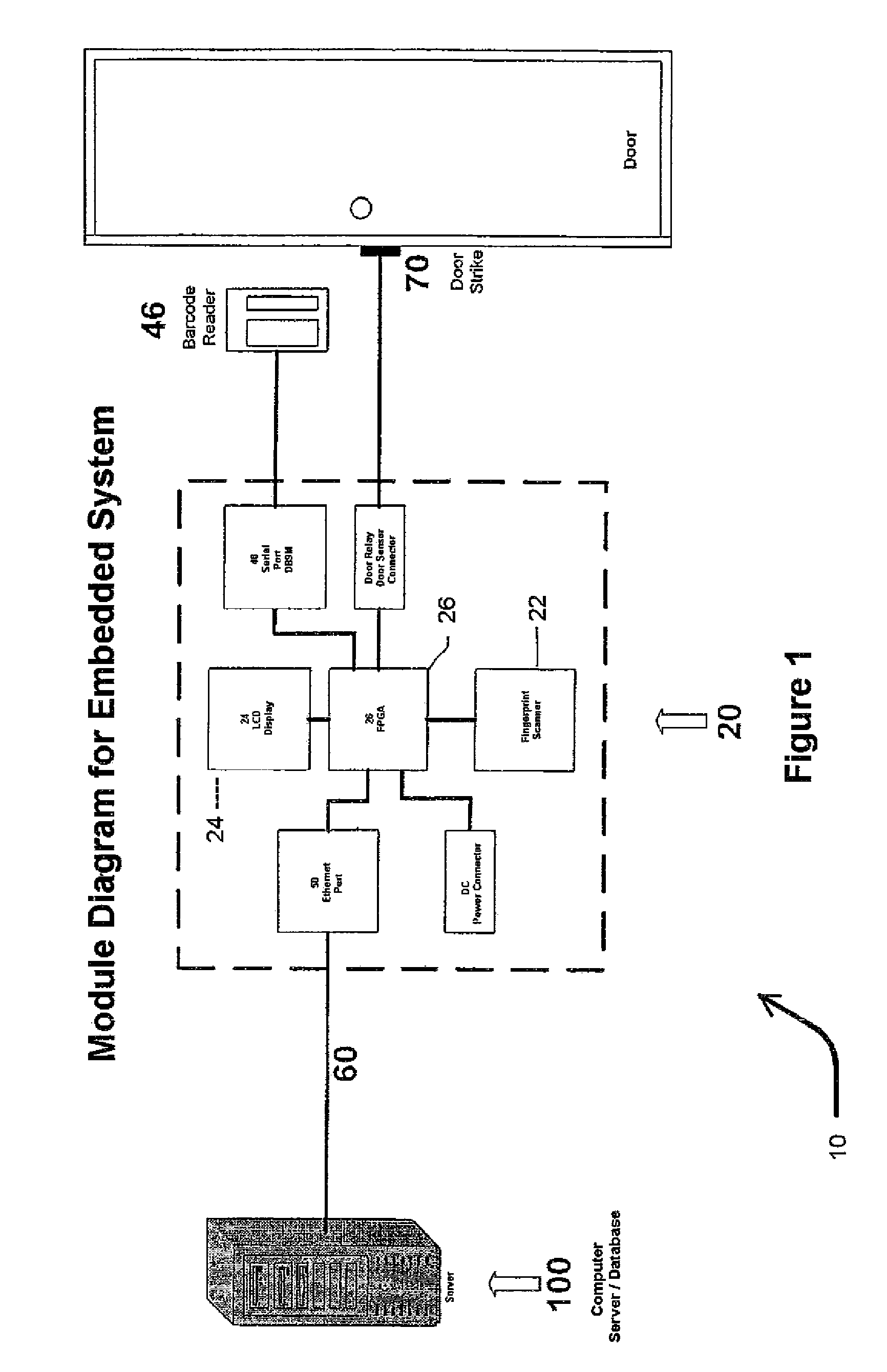

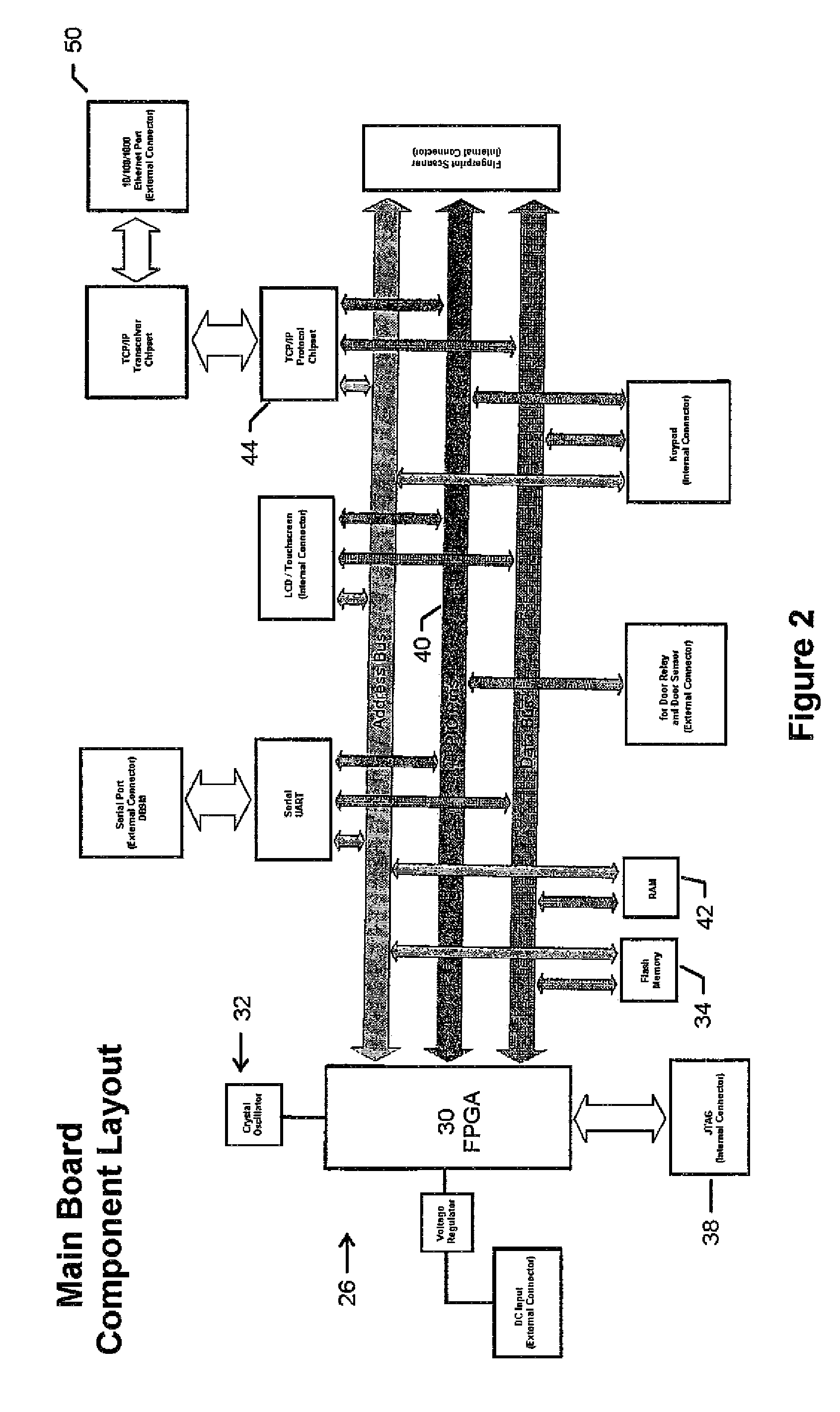

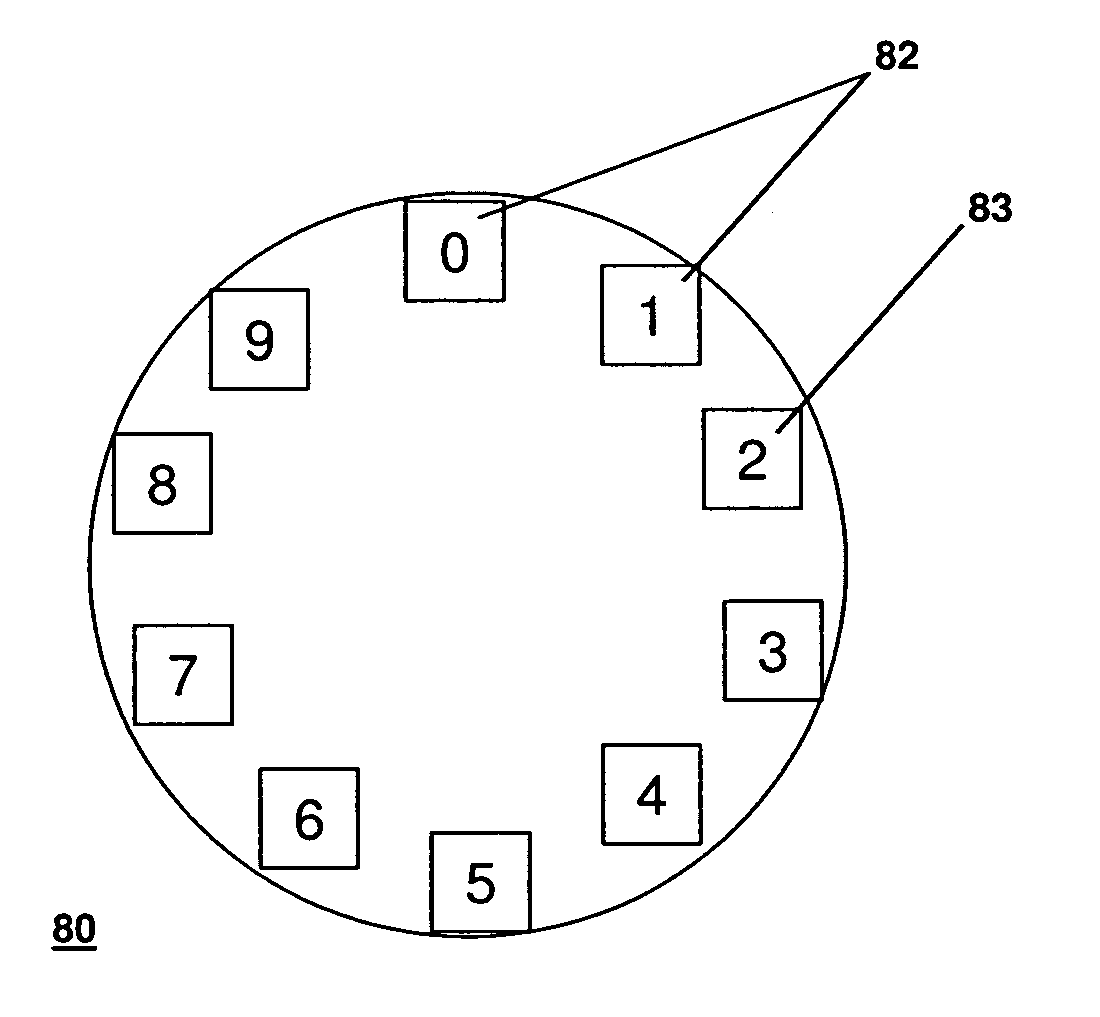

Biometric access control and time and attendance network including configurable system-on-chip (CSOC) processors with embedded programmable logic

ActiveUS7424618B2Compact efficient designCost efficient designElectric signal transmission systemsDigital data processing detailsHard disc driveHuman interaction

A biometric access control and time and attendance system comprises an integrated network including one or more remote access devices in electronic communication with a computer database. Each remote access device comprises a silicon chip based system and preferably includes a biometric input device, a liquid crystal display (LCD), computer processing capabilities based on embedded system architecture with configurable system-on-chip (CSOC) technology, and an electrical output for controlling a door lock or the like. The use of CSOC architecture in lieu of conventional personal computer technology (e.g. mother boards, hard drives, video controllers and the like) allows for a more compact and cost efficient design. A plurality of remote access devices is configured for communication with a primary computer database wherein data corresponding to biometric samples for all authorized users is stored. In an embodiment wherein the biometric input devices comprise fingerprint scanners, the devices are configured to facilitate fingerprint identification by incorporating an auto-targeting capability that enables the user to simply place his or her finger on the fingerprint scanner whereafter the system adjusts the scanned image by automatically shifting the scanned image data to a properly targeted position thereby enabling the system compare the scanned print to the biometric samples in the system's data storage memory. Auto-targeting capability eliminates the requirement for manual targeting present in systems of the background art thereby improving system performance and minimizing reliance on human interaction. The present invention contemplates the use of auto-targeting with other biometric systems, such as facial recognition and / or retinal scanning systems, or any other biometric identification technology.

Owner:PROFILE SOLUTIONS

Multimodal ocular biometric system

ActiveUS20080044063A1Robust and accurateCharacter and pattern recognitionClosed circuit television systemsBiometric dataIris image

A multimodal biometric identification system captures and processes images of both the iris and the retina for biometric identification. Another multimodal ocular system captures and processes images of the iris and / or the from both eyes of a subject. Biometrics based on data provided by these systems are more accurate and robust than using biometrics that include data from only the iris or only the retina from a single eye. An exemplary embodiment emits photons to the iris and the retina of both eyes, an iris image sensor that captures an image of the iris when the iris reflects the emitted light, a retina image sensor that captures an image of the retina when the retina reflects the emitted light, and a controller that controls the iris and the retina illumination sources, where the captured image of the iris and the captured image of the retina contain biometric data.

Owner:MORPHOTRUST USA

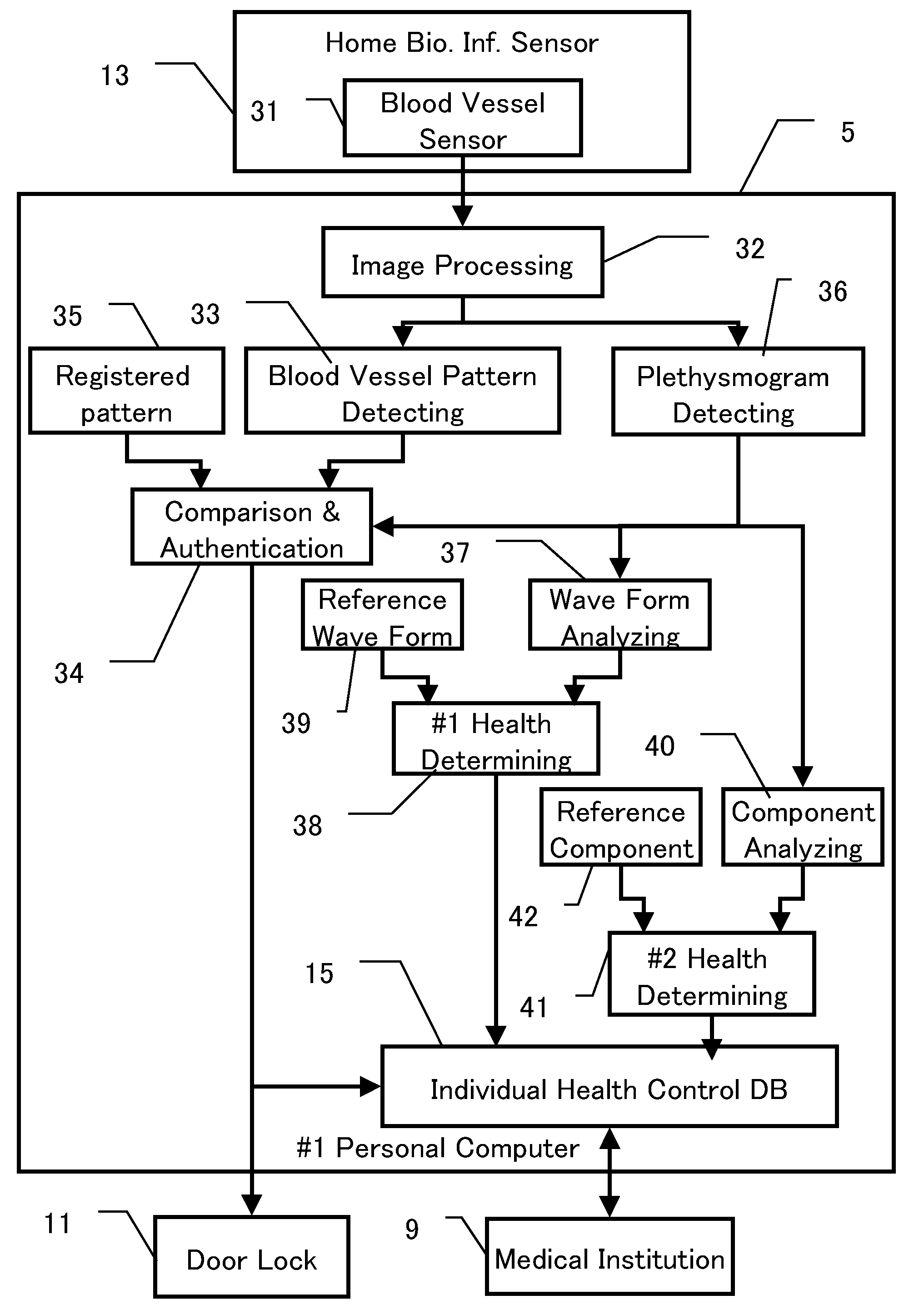

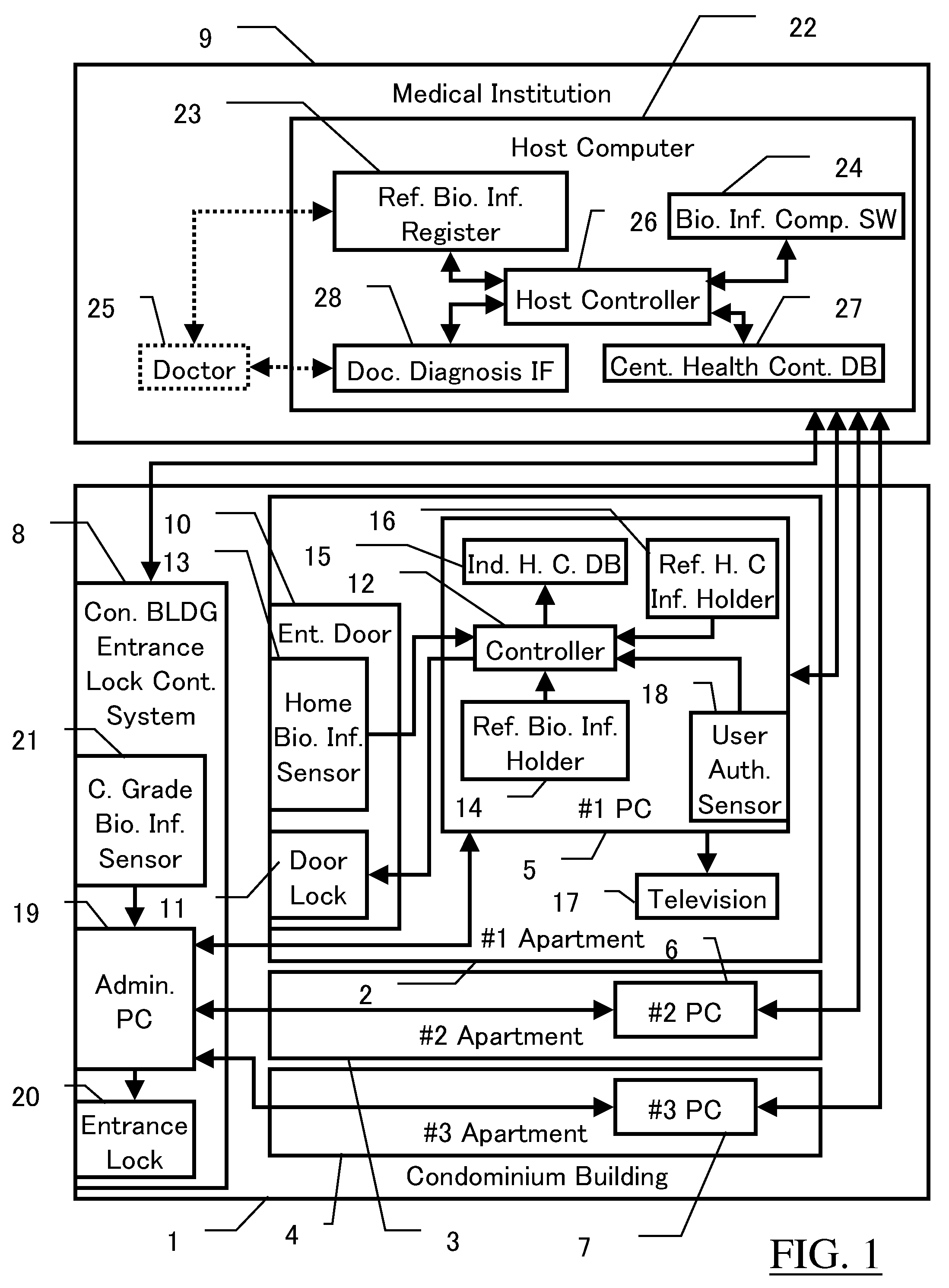

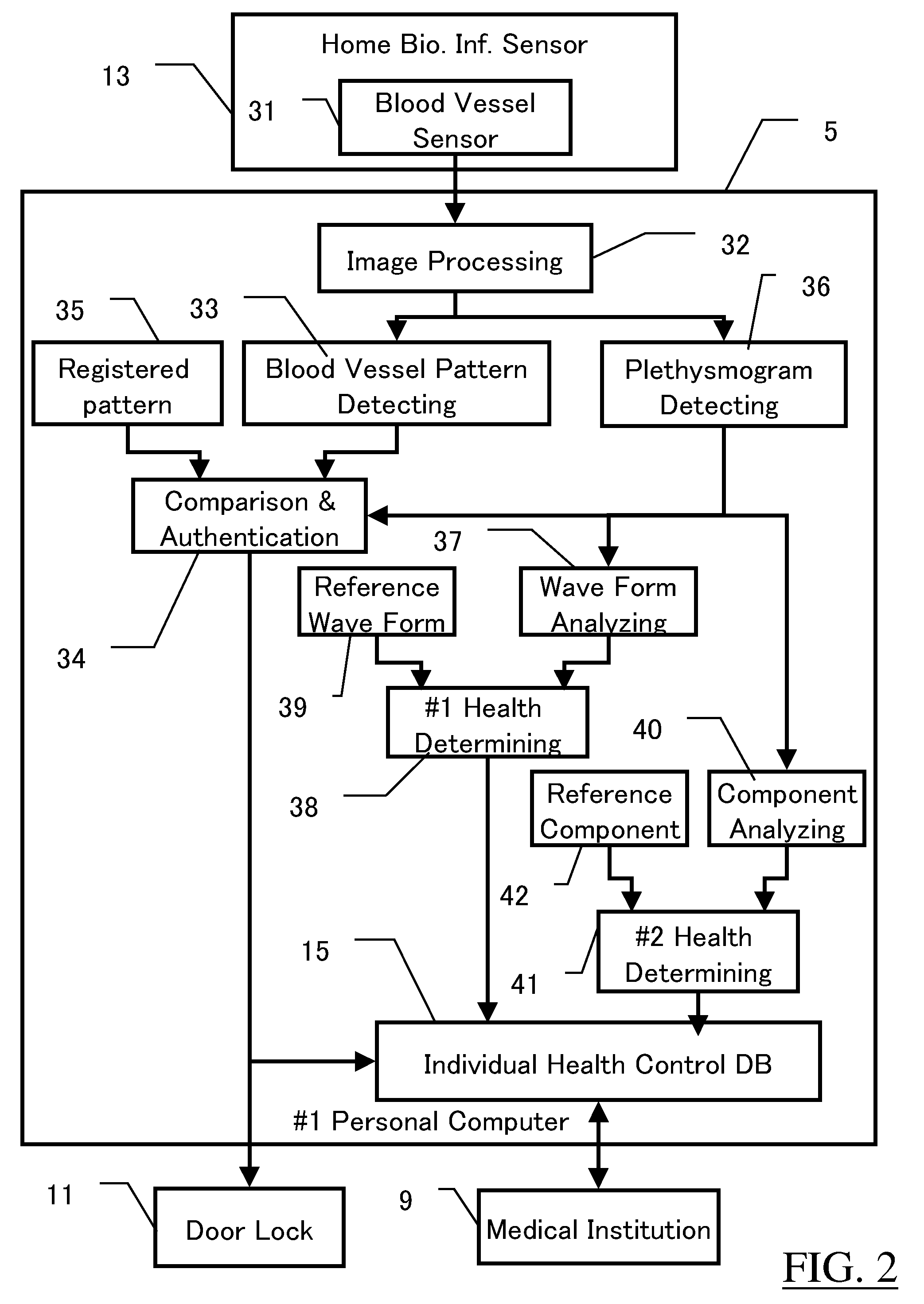

Biometrics System, Biologic Information Storage, and Portable Device

ActiveUS20070177771A1Improve securityPrevent forgeryPerson identificationDigital data authenticationSystems managementBank account

In a biometrics system for a building entrance unlocking or a bank account authentication, reference information registered under administration by the system is transmitted to a room or mobile-phone for private storage, with the original reference information deleted from the system. Biologic information gotten upon authentication is transmitted through wireless system to the room or mobile-phone for comparison with the reference, the result being returned to the system. Or, the reference is tentatively sent back to the system for comparison with the gotten biologic information. The biologic information sent to mobile-phone also includes health control information for storage and display. Mobile-phone also can receive blood pressure information at a waiting lounge of medical institution though wireless local communication even if the main power shut down. The communication between the biometrics system and the mobile-phone is encrypted. The system includes sensor unit and protection unit, the abnormality thereof being separately checked.

Owner:NL GIKEN

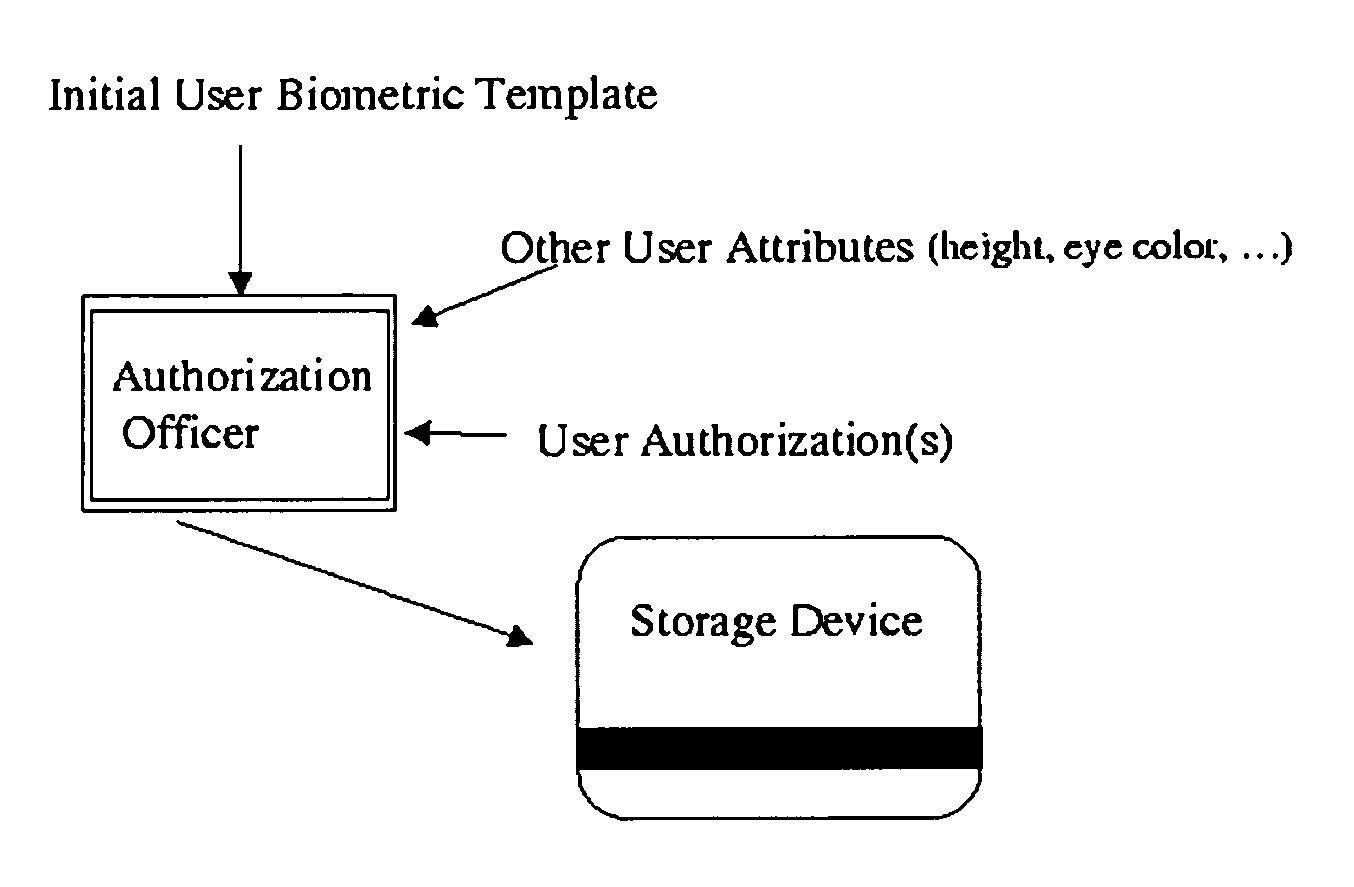

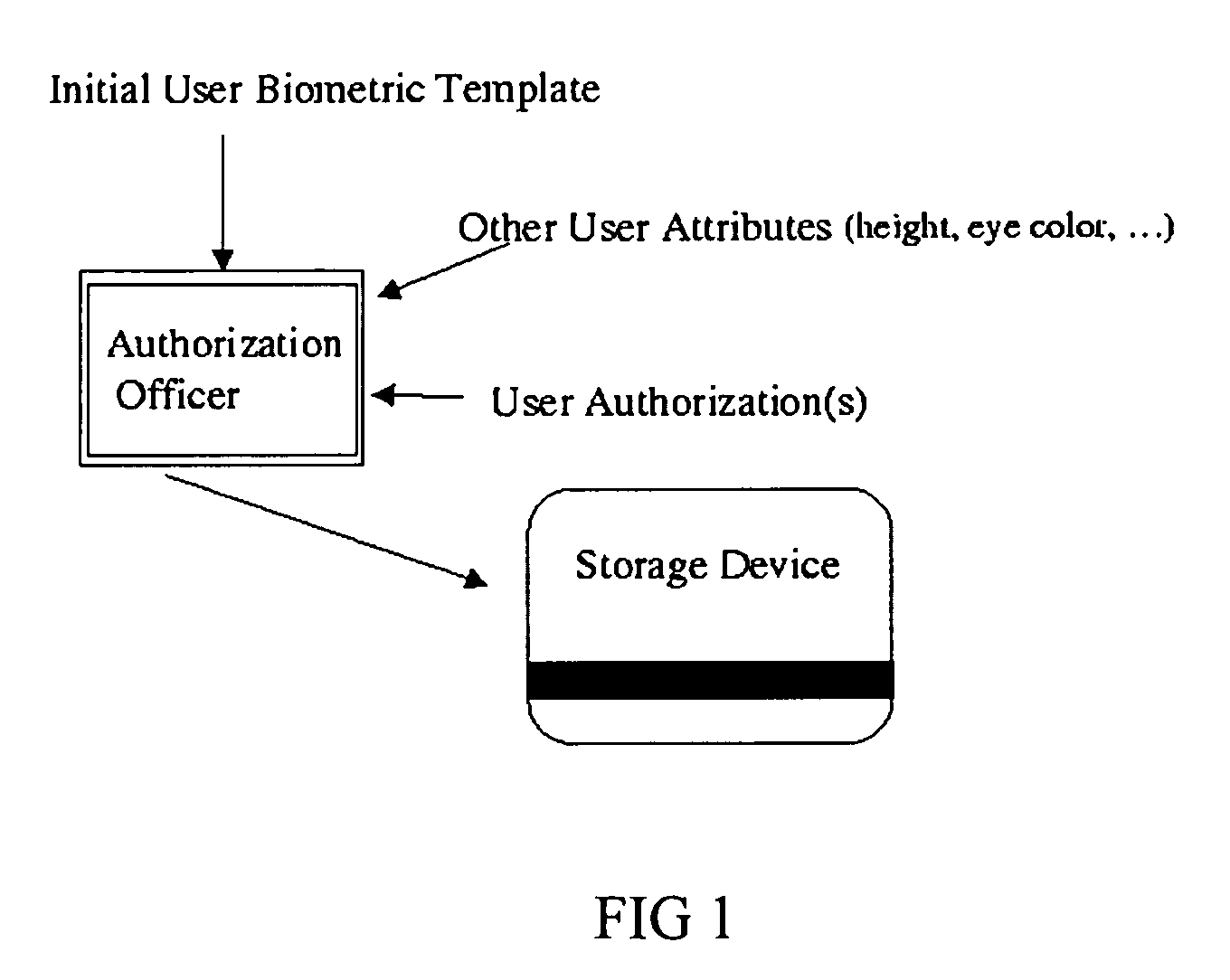

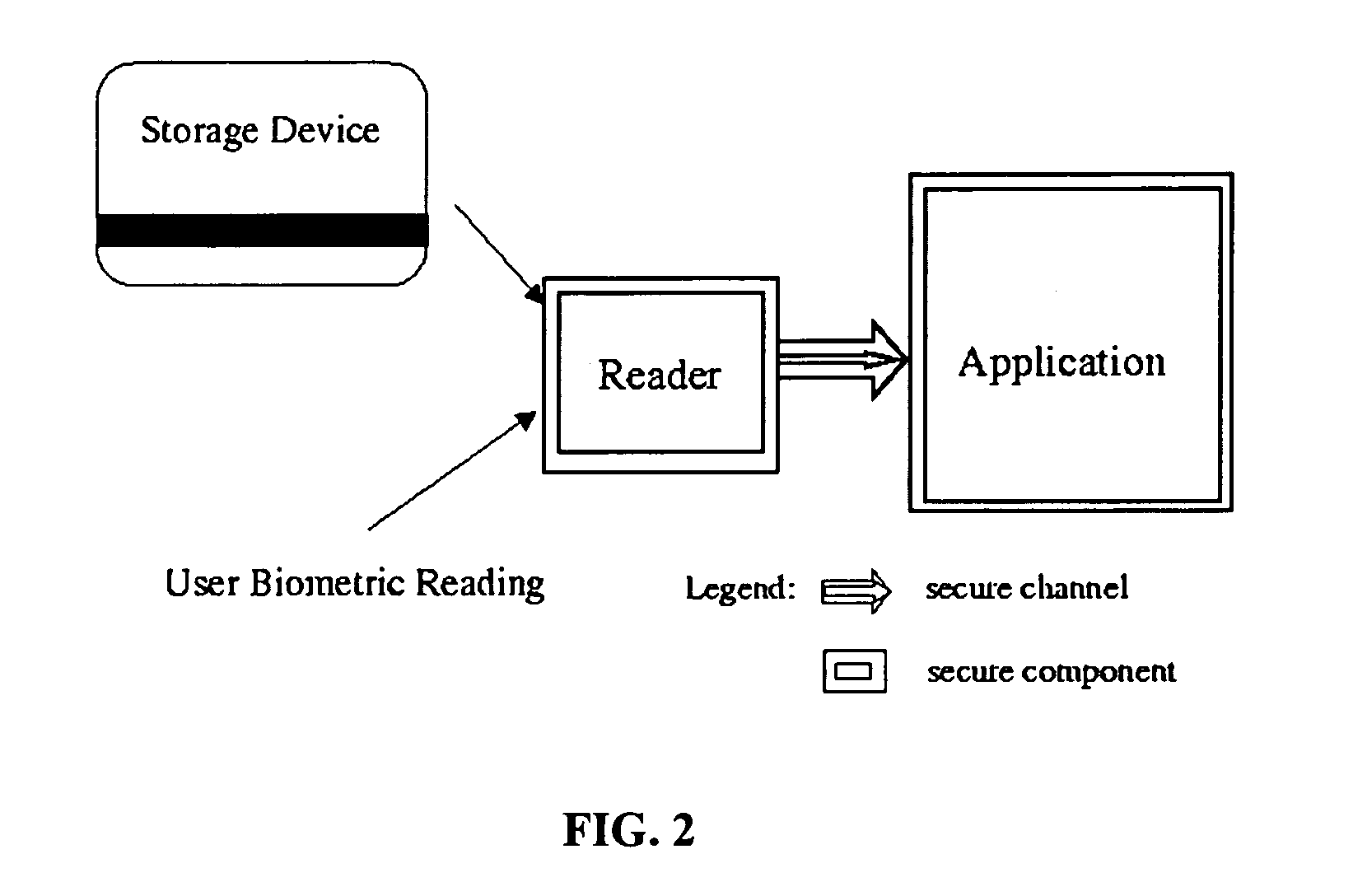

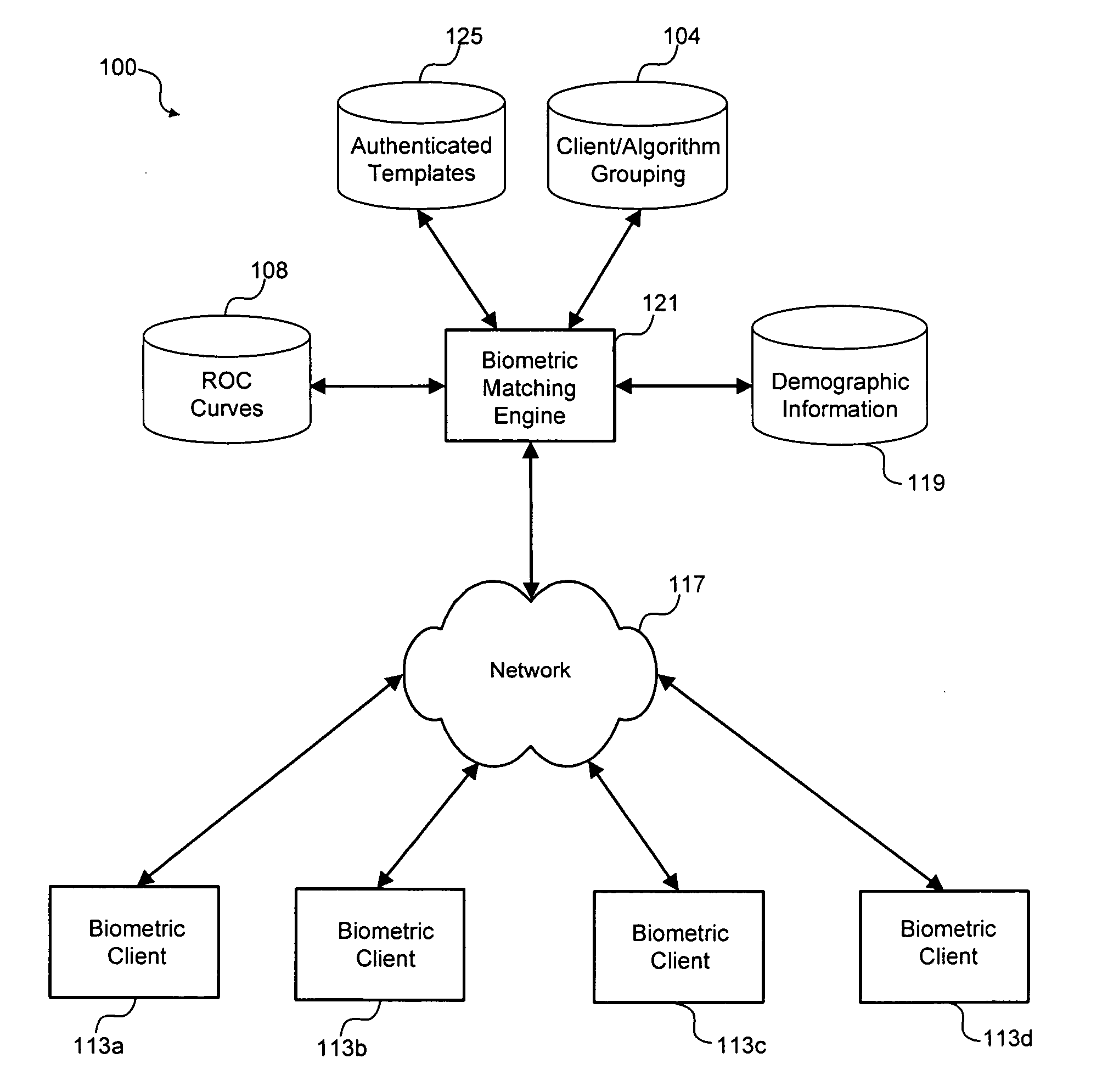

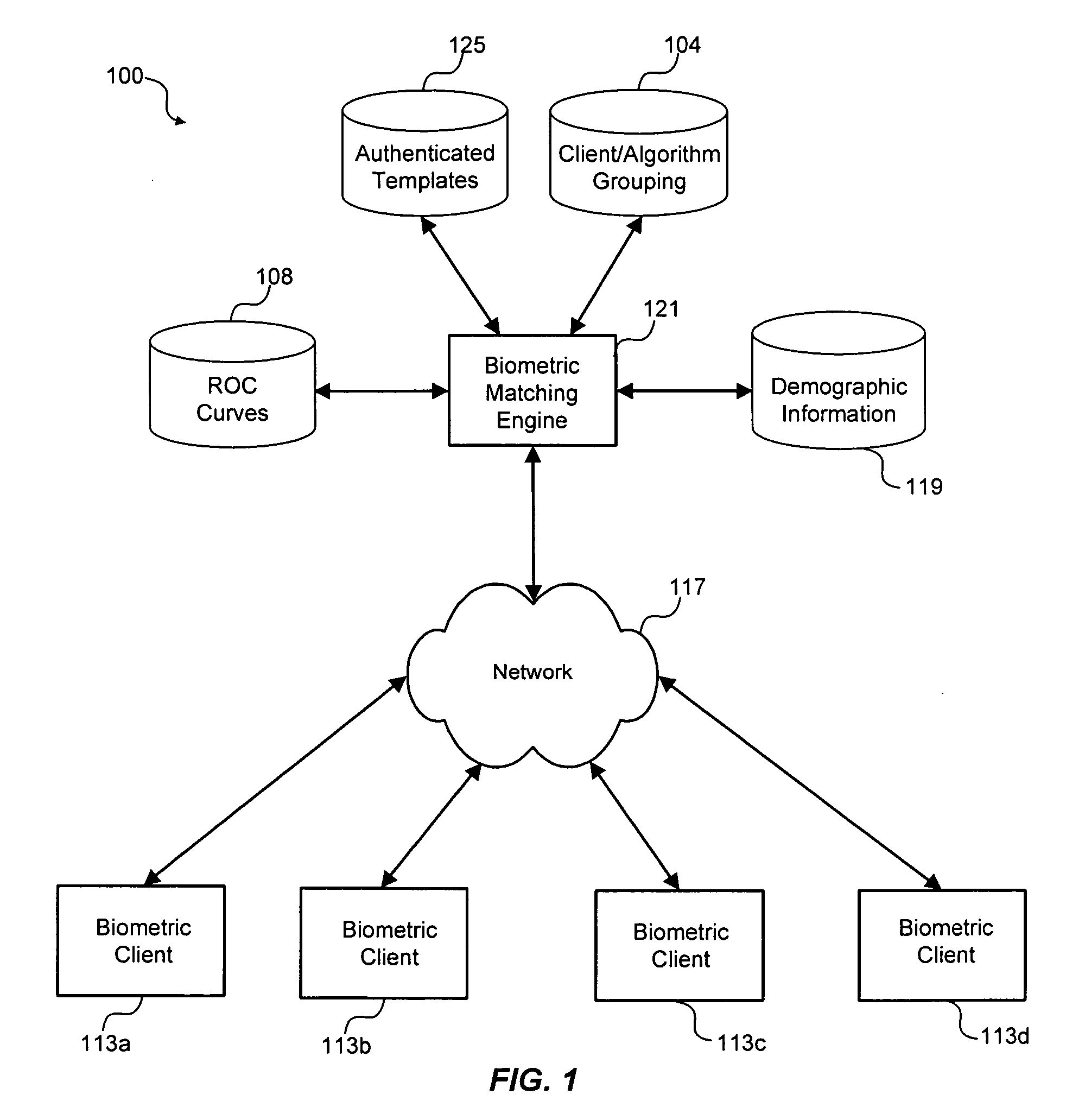

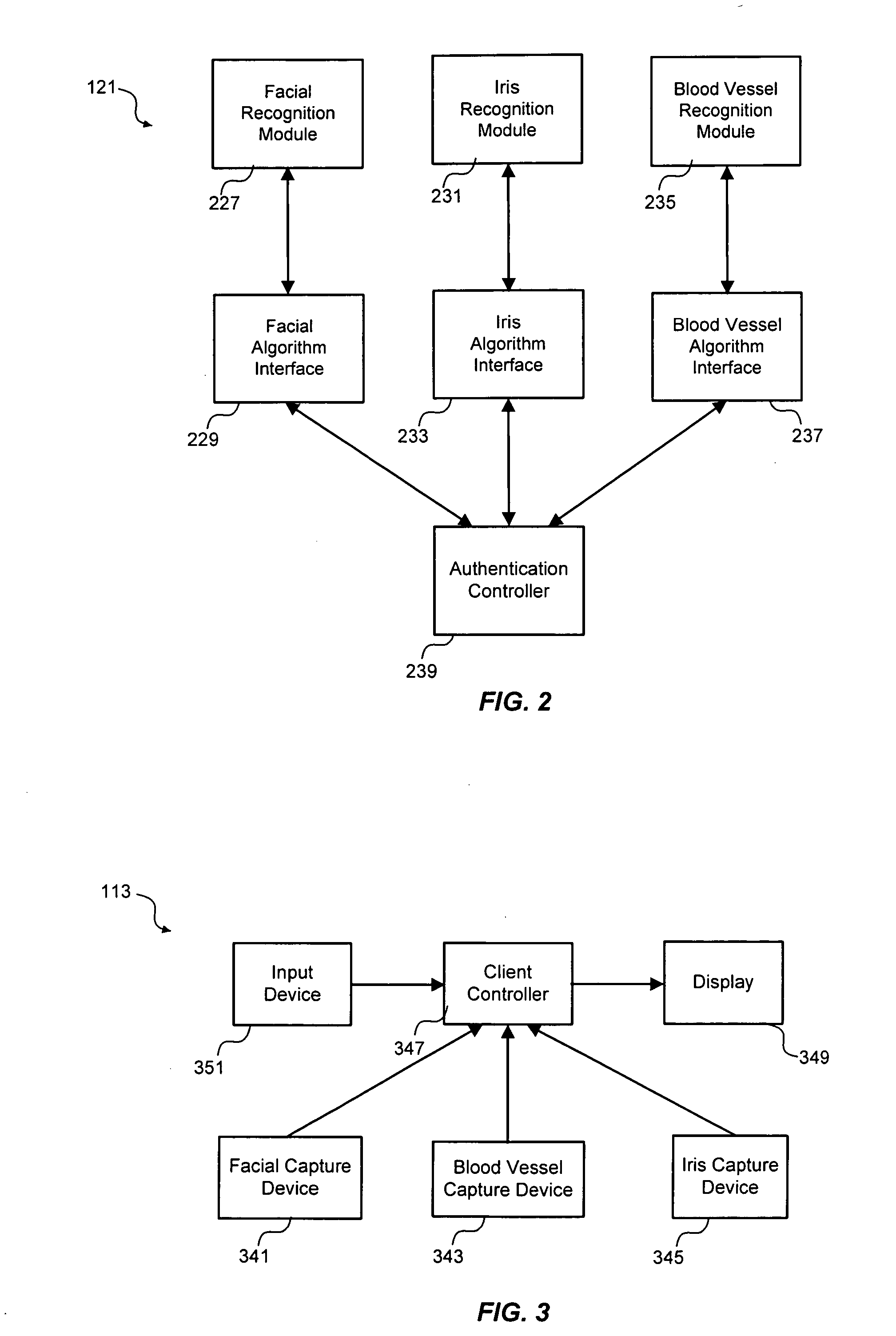

System and method for authenticated and privacy preserving biometric identification systems

InactiveUS7711152B1Opportunities decreaseElectric signal transmission systemsImage analysisOnline modelControl system

A system and method for the identification of users and objects using biometric techniques is disclosed. This invention describes a biometric based identification and authorization systems which do not require the incorporation of an on-line database of stored complete biometrics for the security infrastructure. In order to remove the connectivity requirements, an off-line biometric system is achieved by incorporating an identity verification template (IVT) on a storage device / token (e.g., magnetic strip or smart-card) during the user's registration which provides for a reliable storage medium; however, there are no security requirements required of the token even to protect the privacy of the stored biometric. The IVT does not contain complete information of the user's biometric but allows for the verification of the user when that user later provides a biometric reading. To deal with errors that may be introduced into later scans of the biometric (for example at the time of verification) error correcting techniques, well known in the art of communication and error control systems, are incorporated into the system. The system is also usable in the online model. Moreover, it may also be used to enable cryptographic operations by being used to partially compose or encrypt private keys for cryptographic operation.

Owner:GIDIPO LLC

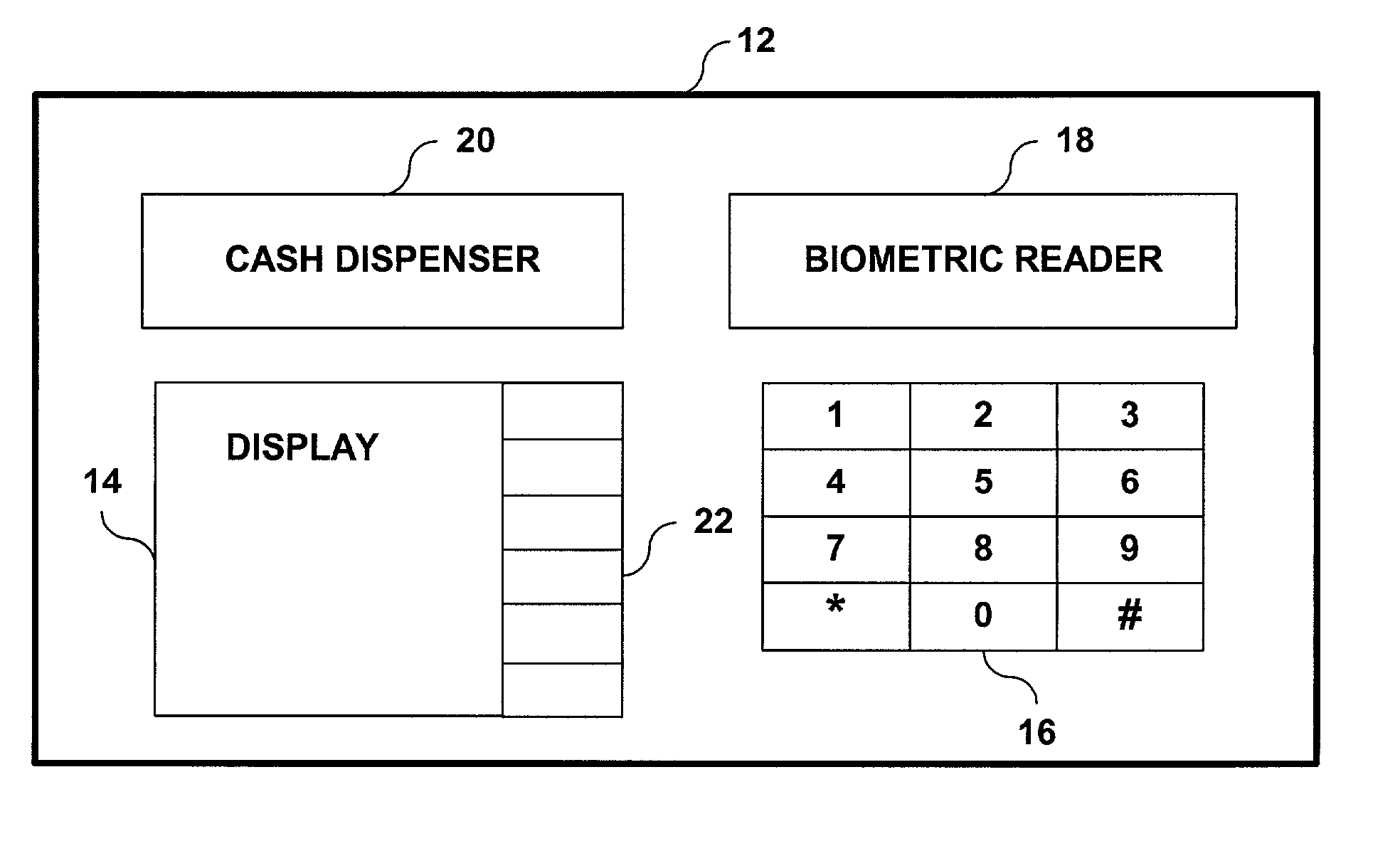

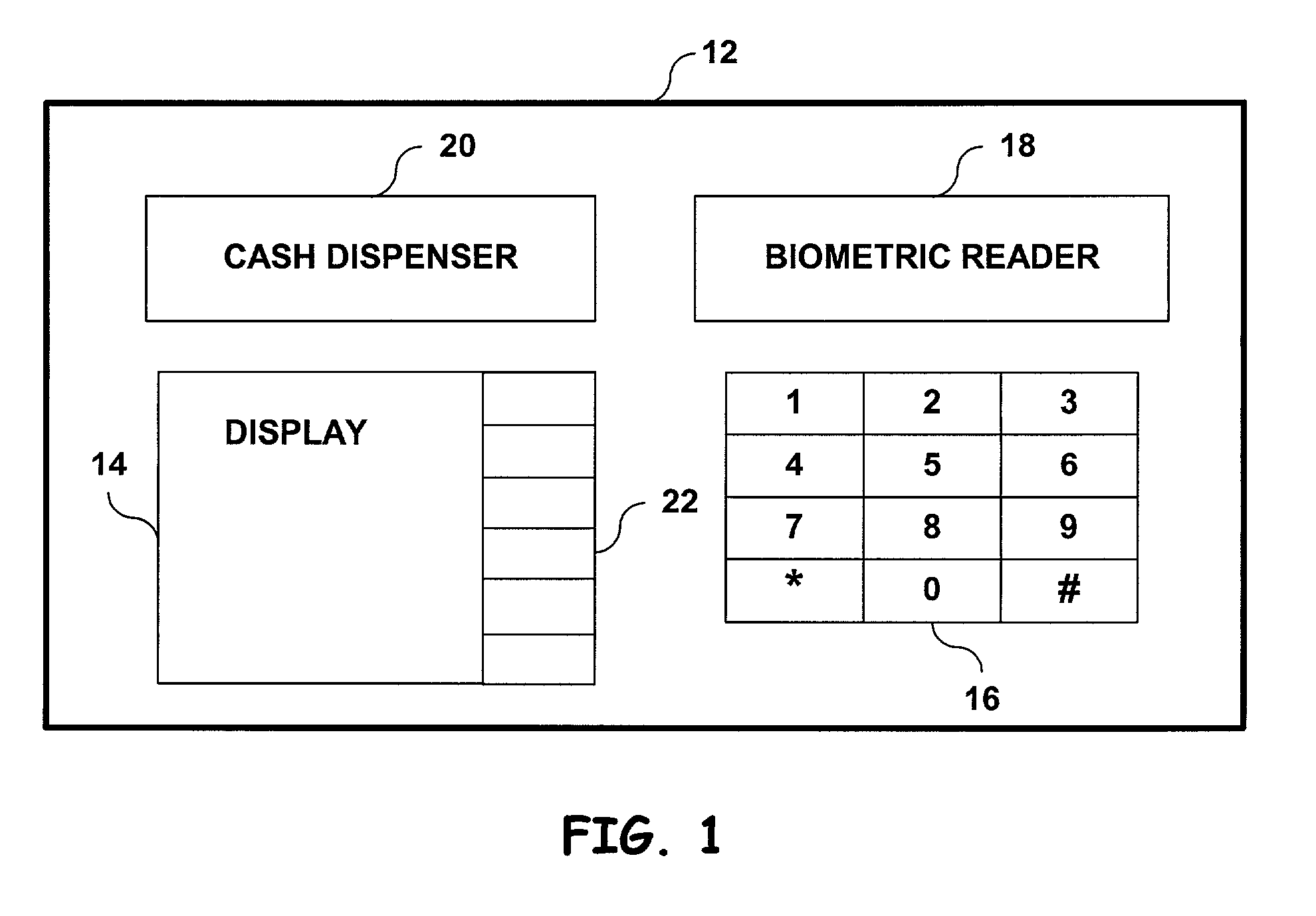

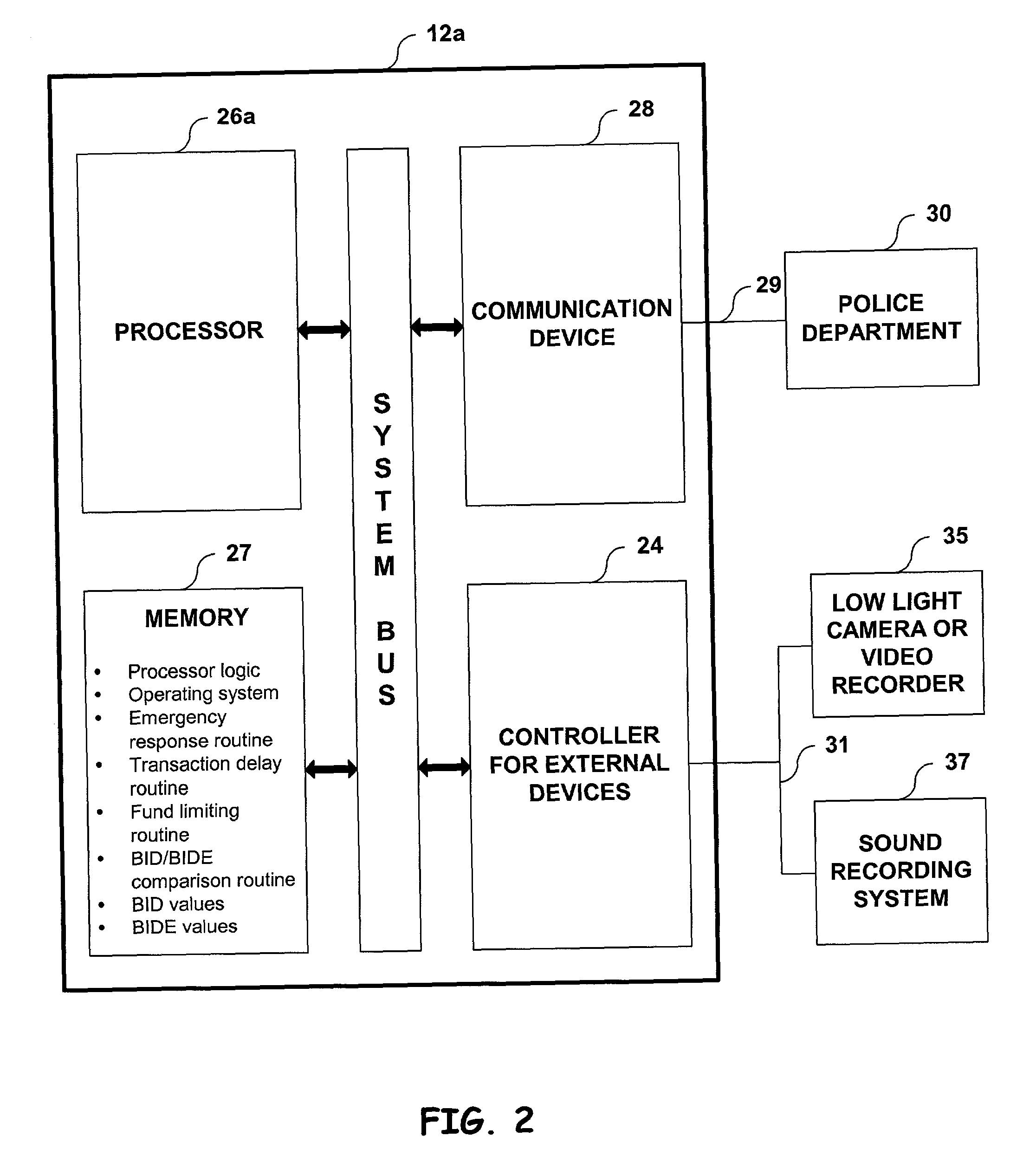

Biometric system and method for detecting duress transactions

InactiveUS20020038818A1Complete banking machinesCharacter and pattern recognitionBiometric systemBiometric trait

A system for responding to a duress identification made at a biometric identification site. The system may include a processor, a memory, a biometric reader for collecting biometric information about a user, wherein the biometric information is used for determining if the user is an authorized user of the system. The system may also include a set of instructions stored in the memory, the set of instructions executable by the processor to determine whether the biometric information represents a normal identification or a duress identification; if the biometric information represents a duress identification, the system may initiate an emergency response, such as (for example) triggering a silent alarm.

Owner:ZINGHER JOSEPH P +1

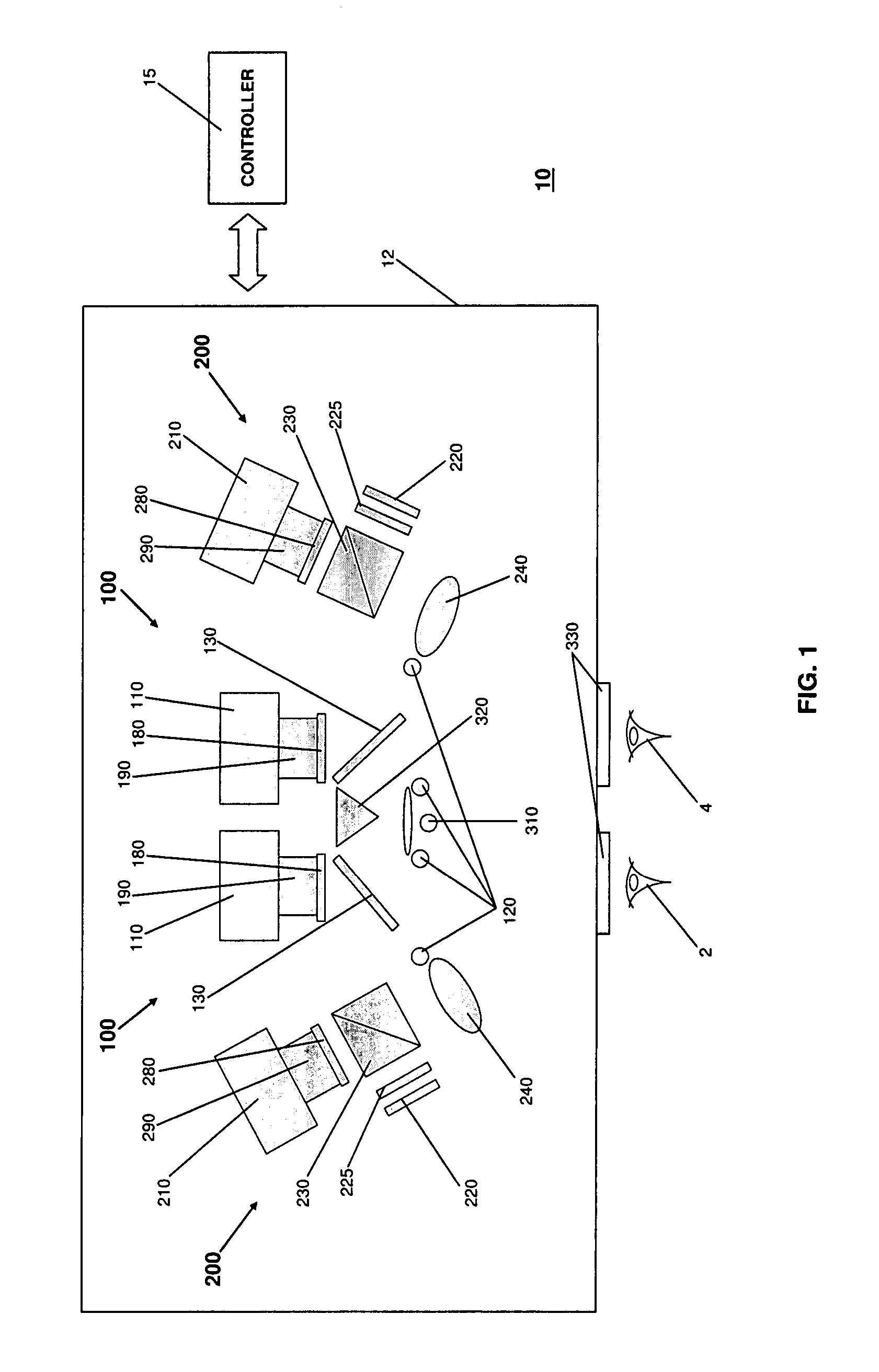

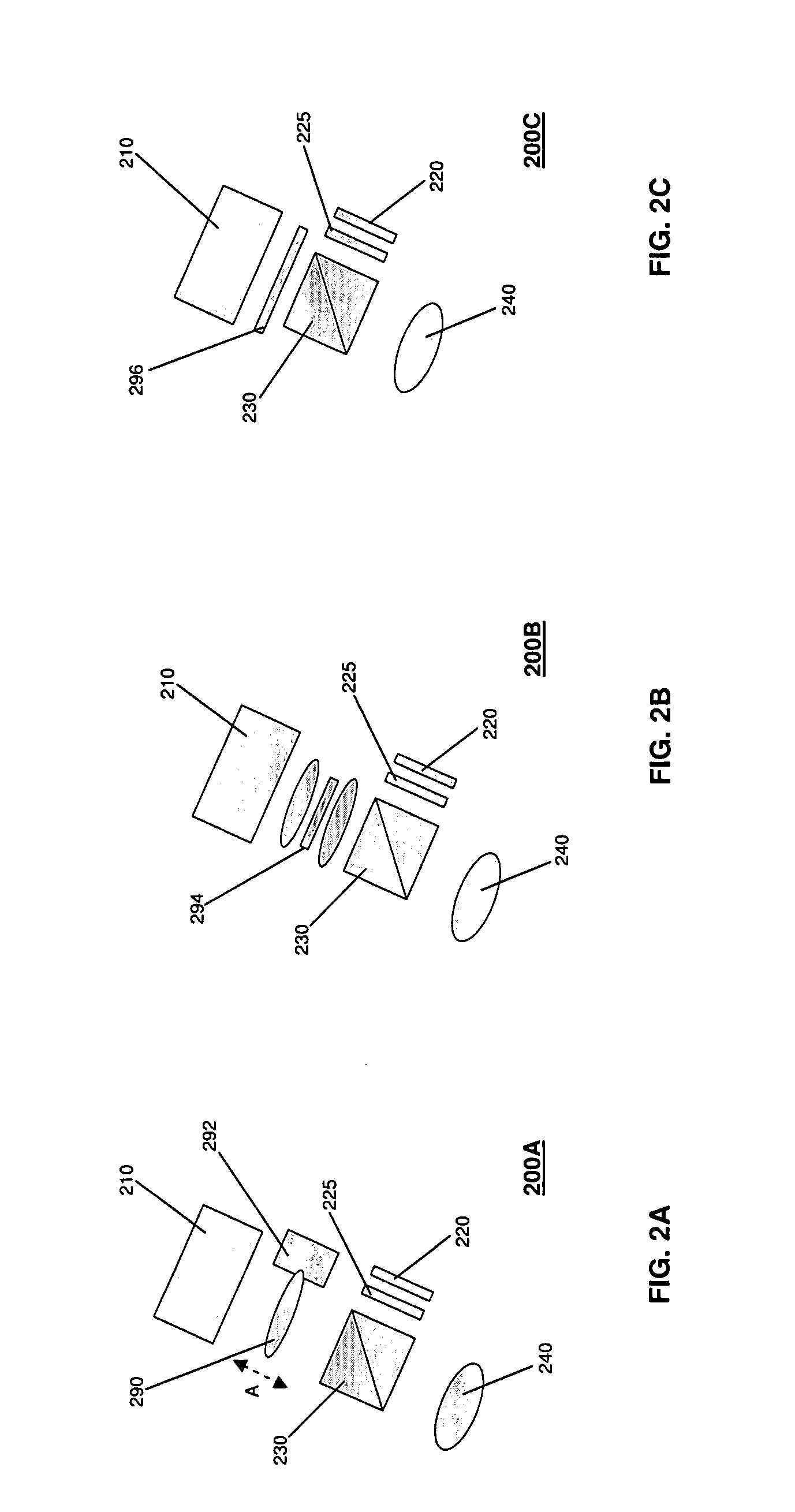

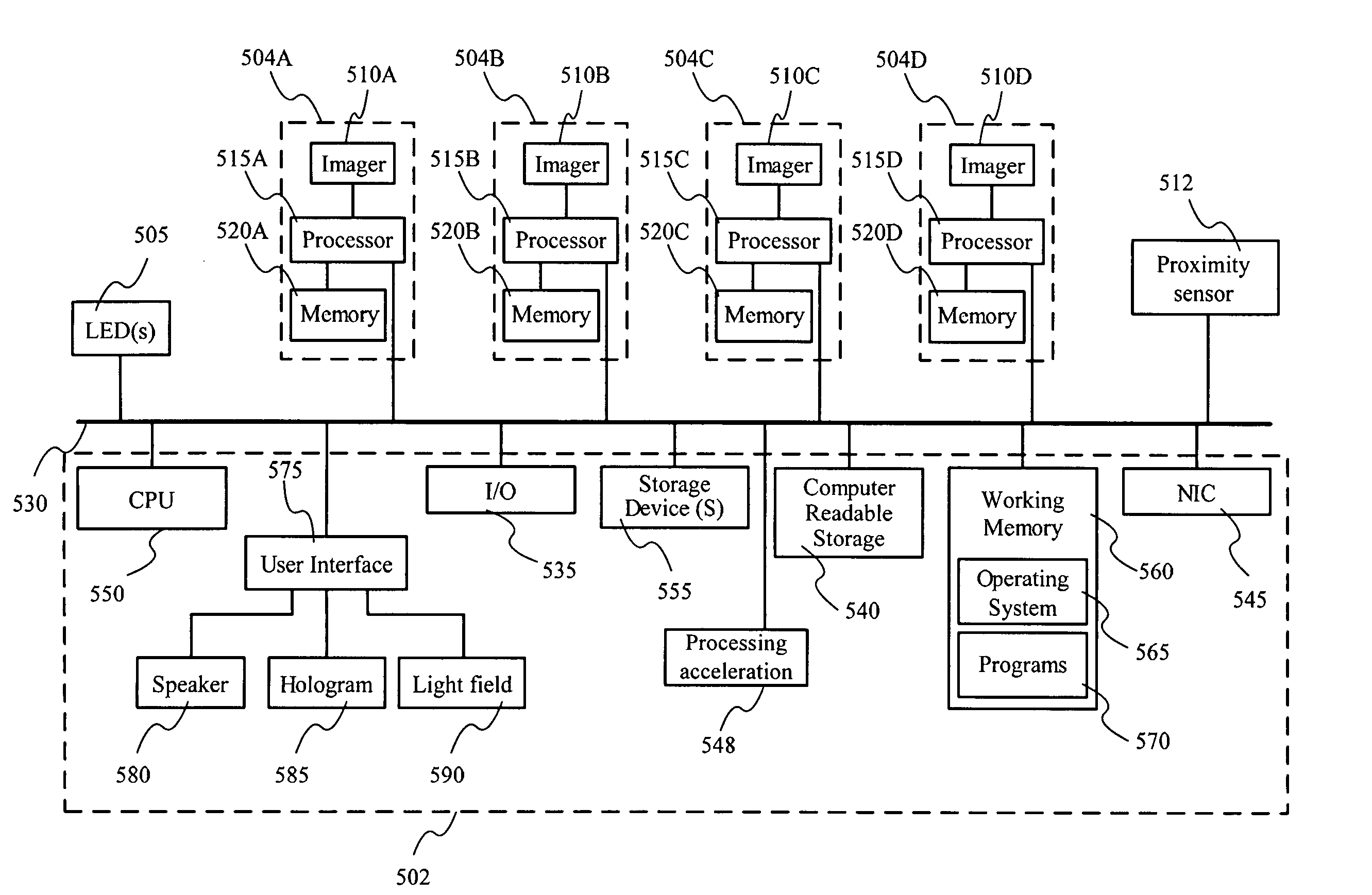

Contactless Multispectral Biometric Capture

A number of biometric systems and methods are disclosed. A system according to one embodiment includes an illumination subsystem, an imaging subsystem, and an analyzer. The illumination subsystem is disposed to illuminate a target space. The imaging subsystem is configured to image the target space under distinct optical conditions. The analyzer is provided in communication with the illumination subsystem, the imaging subsystem, and the three-dimensional subsystem. The analyzer also has instructions to operate the subsystems to collect substantially simultaneously a plurality of images of the object disposed at the predetermined spatial location under multispectral conditions.

Owner:HID GLOBAL CORP

Method and apparatus for stereo, multi-camera tracking and RF and video track fusion

Owner:SRI INTERNATIONAL

Multimodal biometric analysis

ActiveUS20060210119A1Electric signal transmission systemsImage analysisBiometric systemBiometric trait

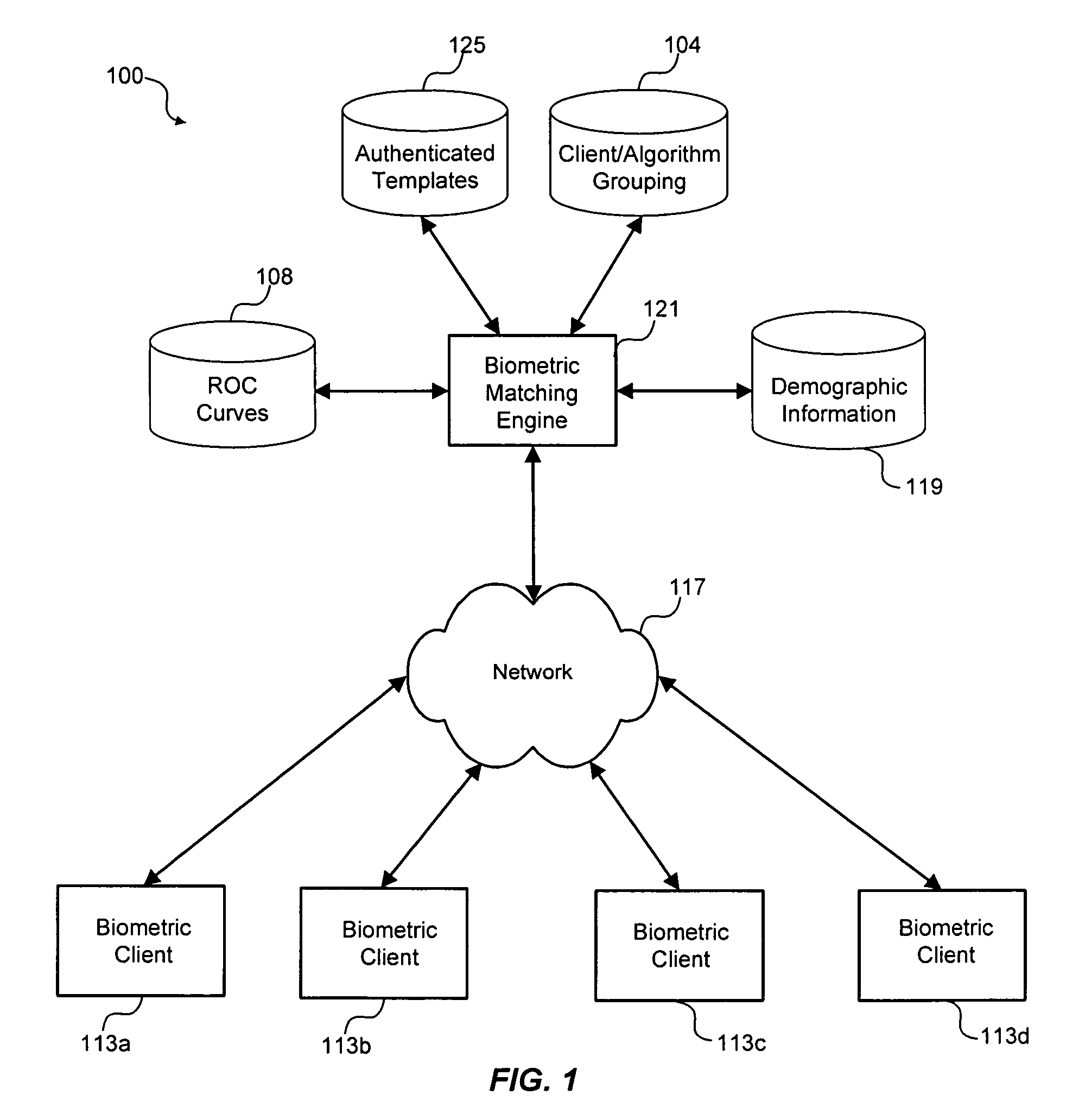

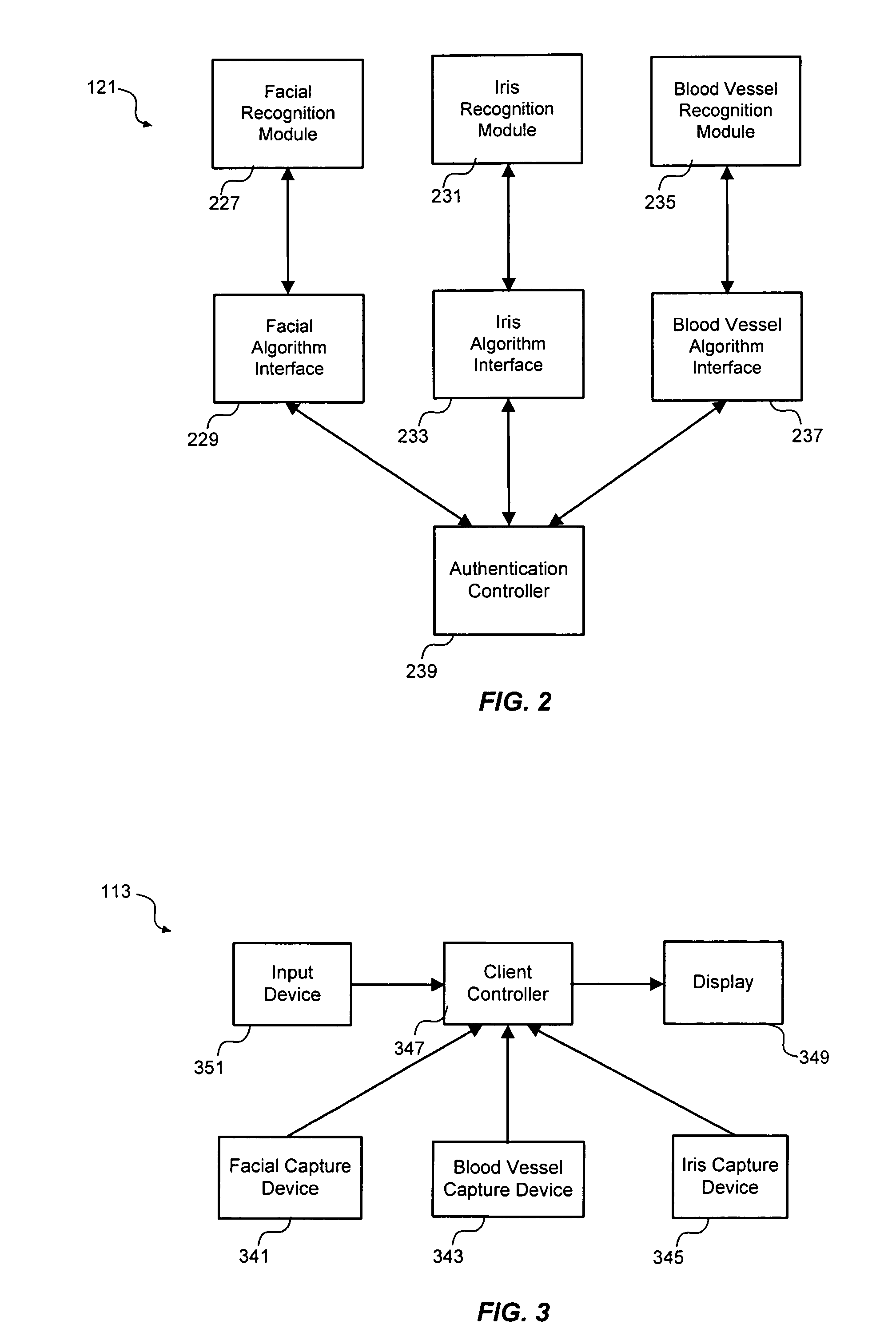

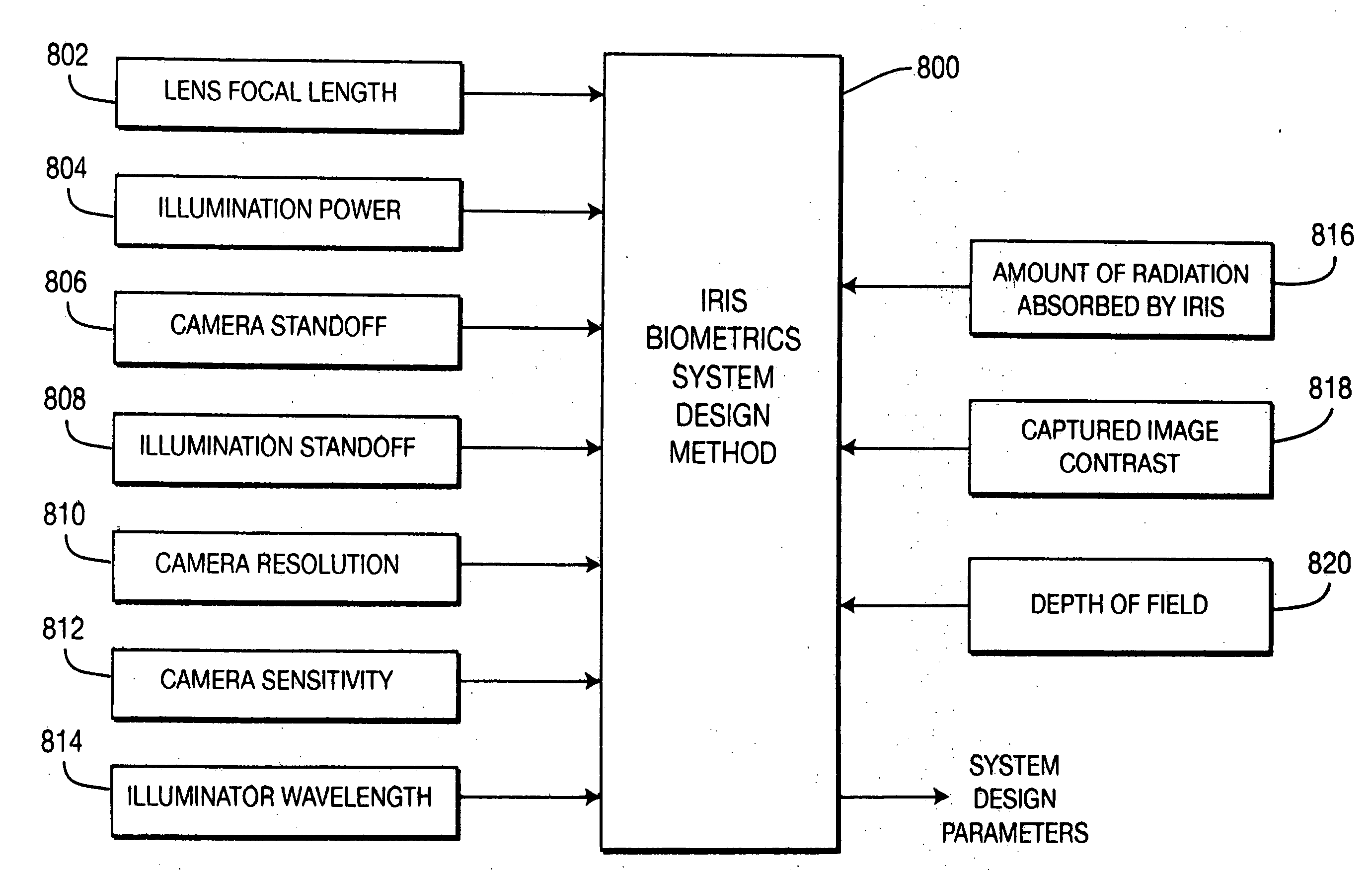

A biometric system that uses readings from a plurality of biometrics of a user is disclosed. The biometric system includes a first and second biometric readers, a first and second biometric matching engines and a processor. The first biometric reader producing a first measured biometric that is processed by the first biometric matching engine to deliver a first value, which is indicative of a likelihood that the first measured biometric matches a first stored biometric reading. A plurality of first values are gathered prior to the first value. The second biometric reader delivers a second measured biometric for processing by the second biometric matching engine to produce a second value, which is indicative of a likelihood that the second measured biometric matches a second stored biometric reading. A plurality of second values are gathered prior to the second value. The first and second biometric readers measure a different biometric, or the first and second biometric matching engines use a different algorithm. The processor normalizes the first value according to the plurality of first values, normalizes the second value according to the plurality of second values, and determines if the user matches a person using the normalized first and second values.

Owner:IMAGEWARE SYST

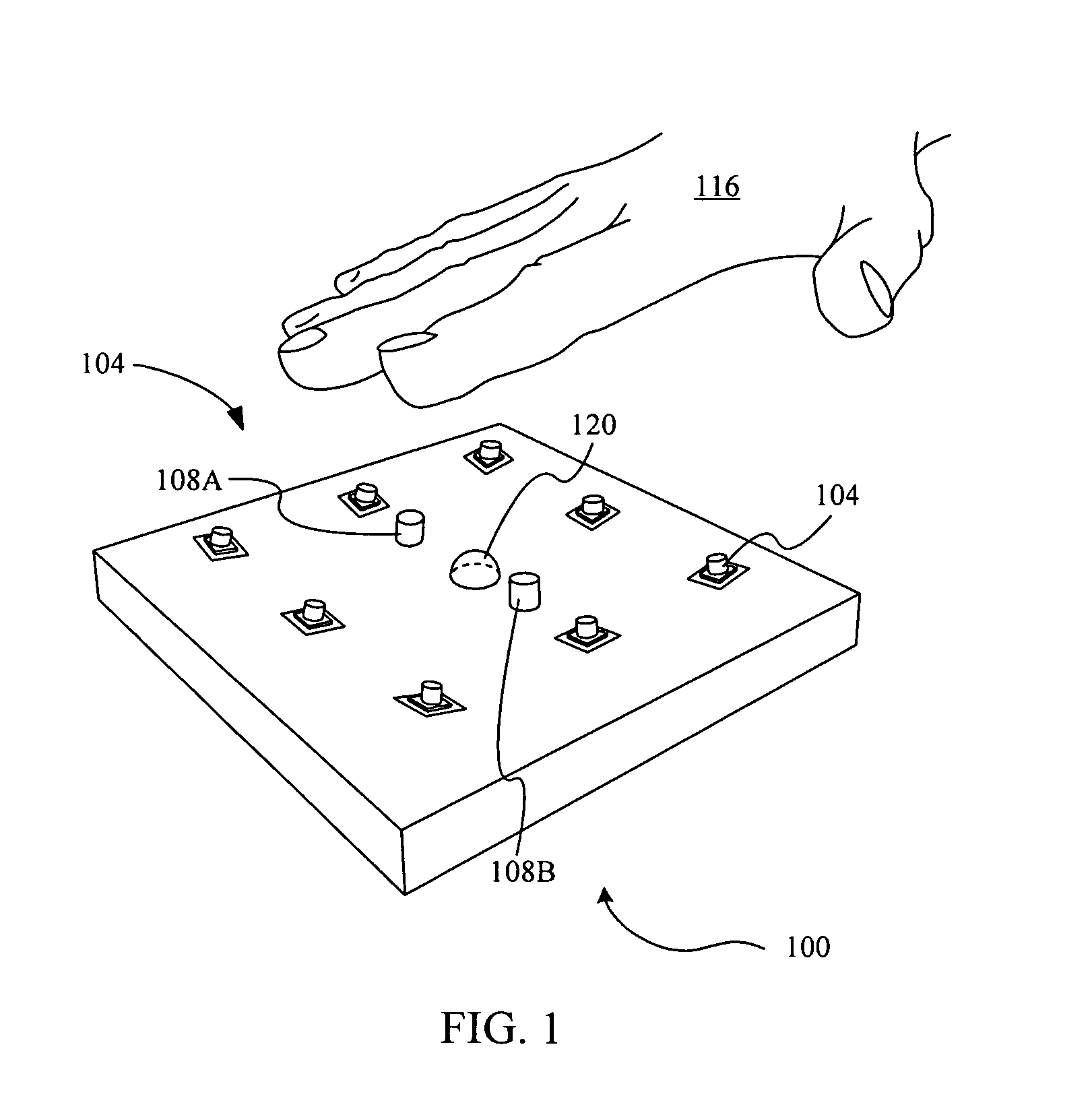

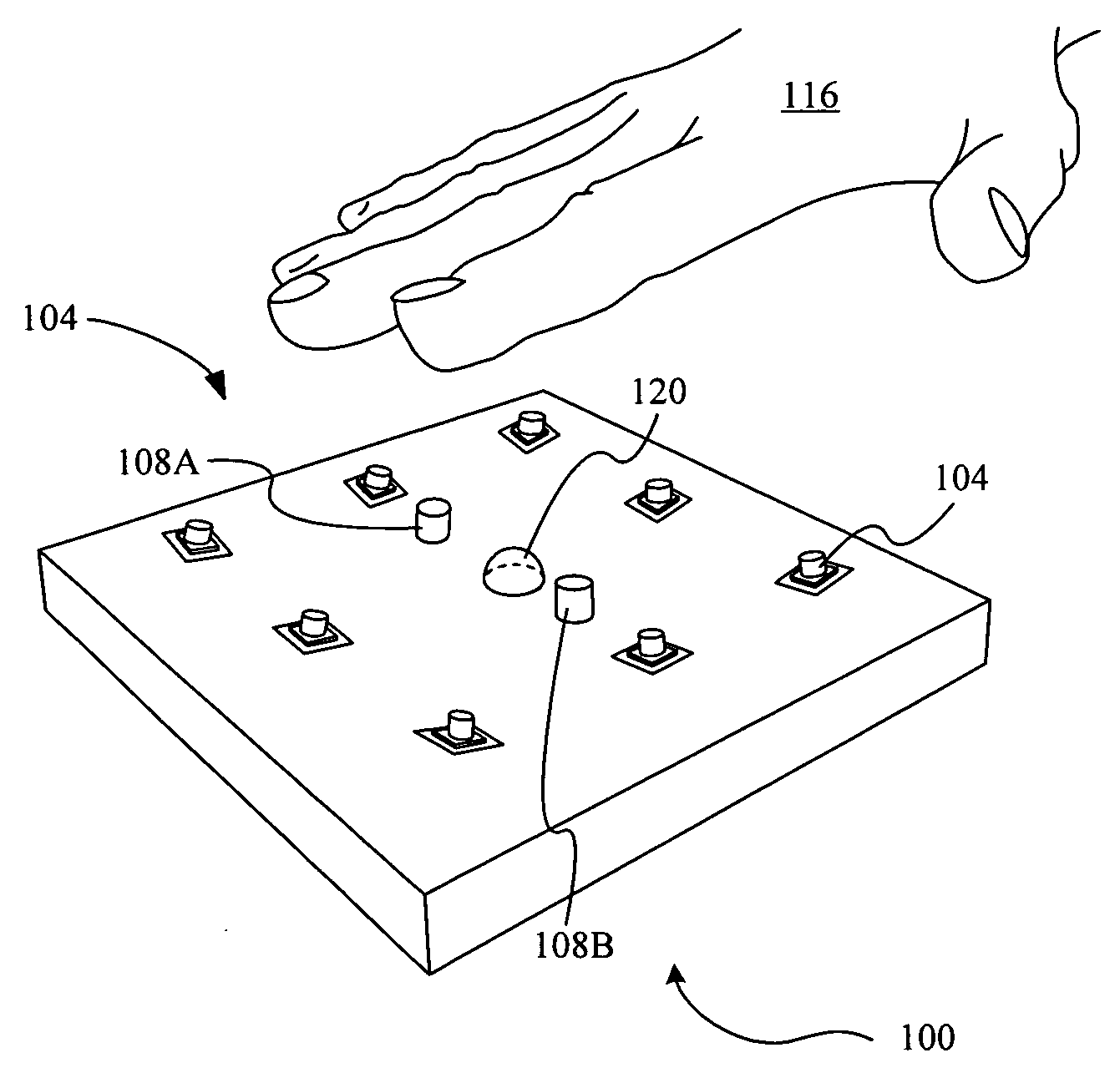

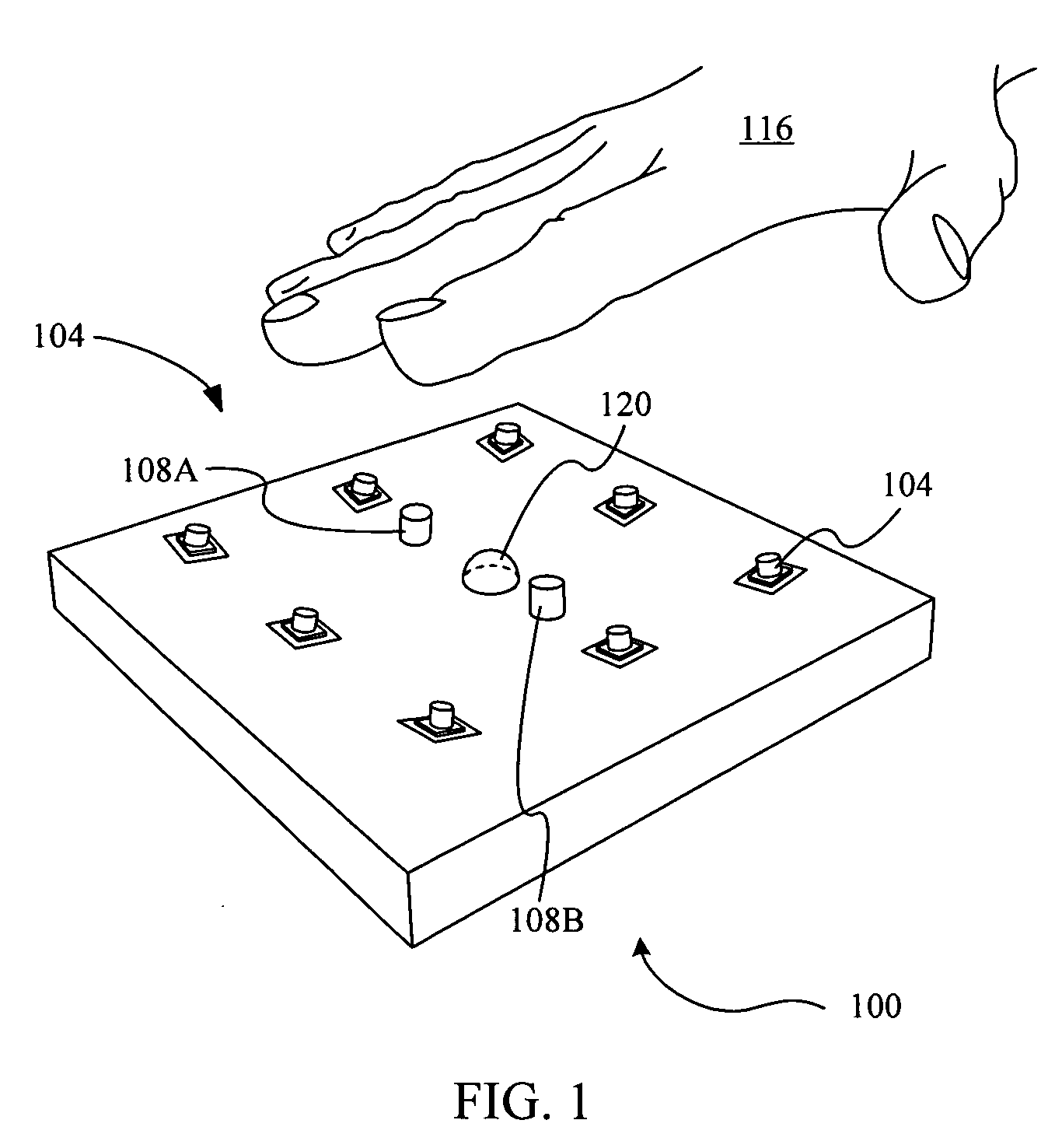

Whole-Hand Multispectral Biometric Imaging

A number of biometric systems and methods are disclosed. A system according to one embodiment includes an illumination subsystem, an imaging subsystem, and an analyzer. The illumination subsystem is disposed to illuminate a target space. The imaging subsystem is configured to image the target space under distinct optical conditions. The analyzer is provided in communication with the illumination subsystem, the imaging subsystem, and the three-dimensional subsystem. The analyzer also has instructions to operate the subsystems to collect substantially simultaneously a plurality of images of the object disposed at the predetermined spatial location under multispectral conditions.

Owner:HID GLOBAL CORP

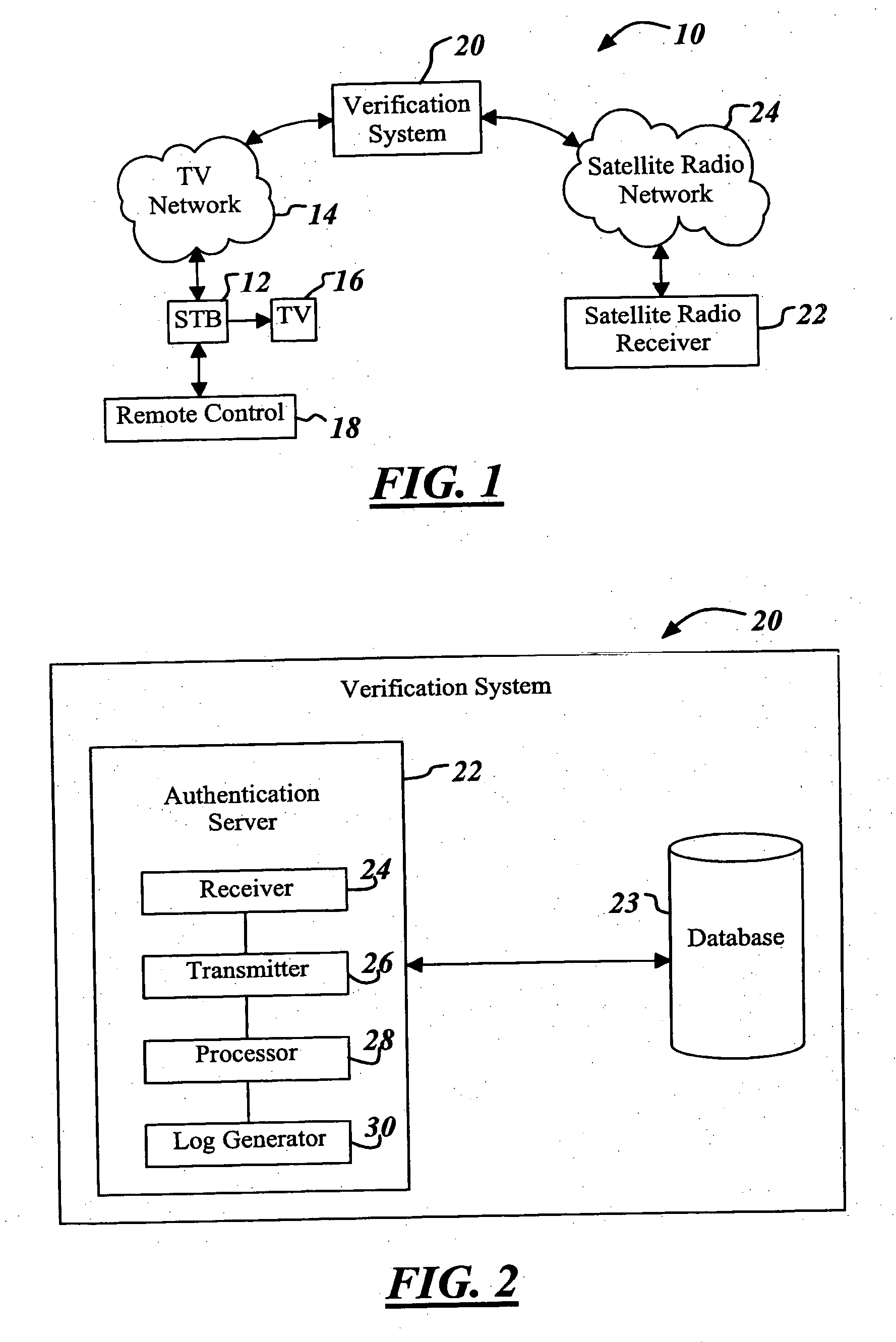

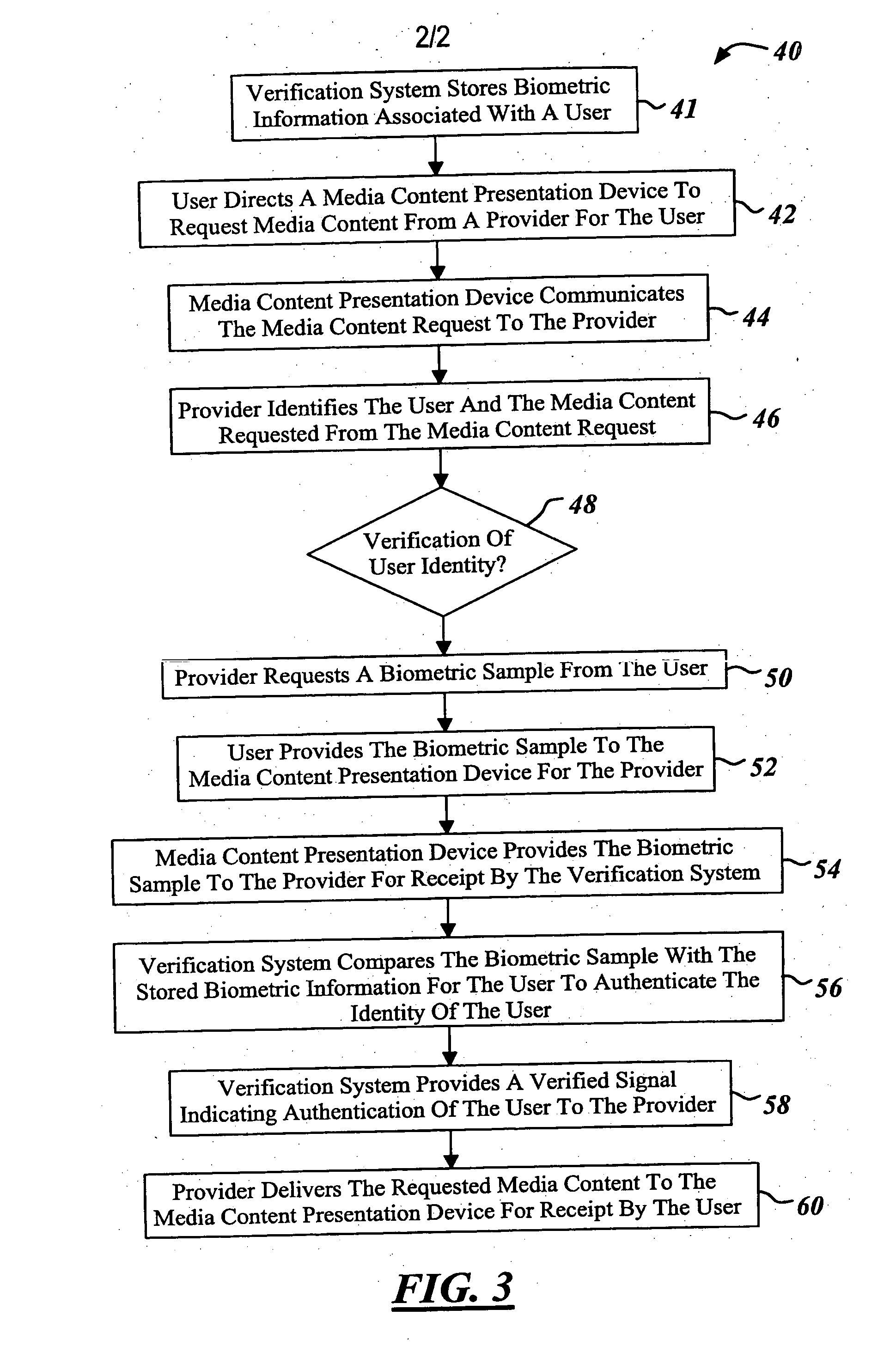

Method and system for biometric based access control of media content presentation devices

InactiveUS20060271791A1Strong claimBroadcast-related systemsBroadcast transmission systemsInternet privacyMedia access control

A centralized biometric system for verifying the identity of a user over a communications network includes a device that stores biometric information in association with information that identifies users. The system further includes a receiver that receives, from a media content presentation device via a communications network, a biometric sample provided by a user requesting media content from a provider. The provider delivers the media content requested by the user from the communications network to the media content presentation device for receipt by the user contingent upon the identity of the user being verified. The system further includes a processor that compares the biometric sample provided by the user to stored biometric information of the user. The processor verifies the identity of the user upon a sufficient correspondence between the biometric sample provided by the user and the stored biometric information of the user.

Owner:SBC KNOWLEDGE VENTURES LP

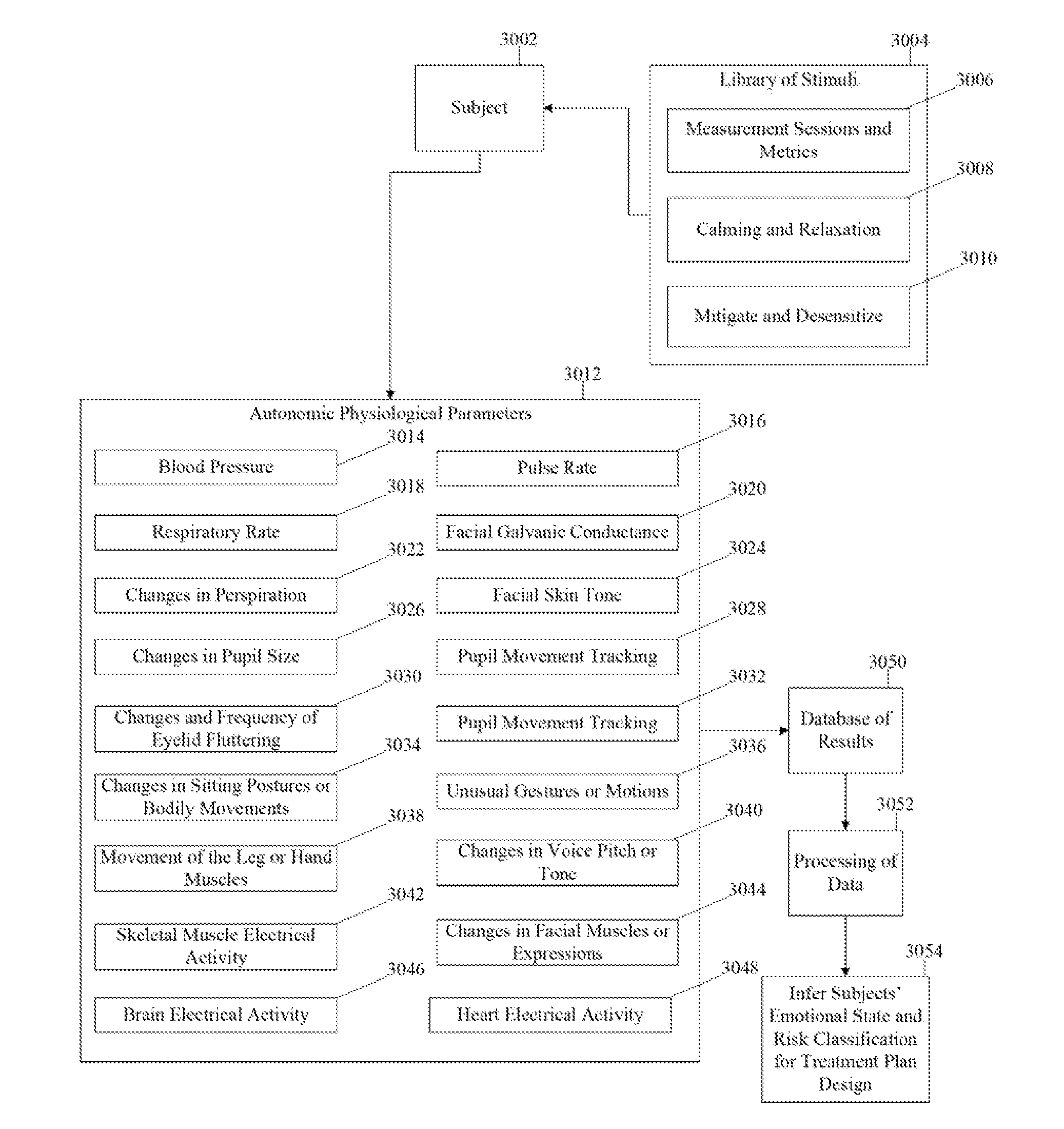

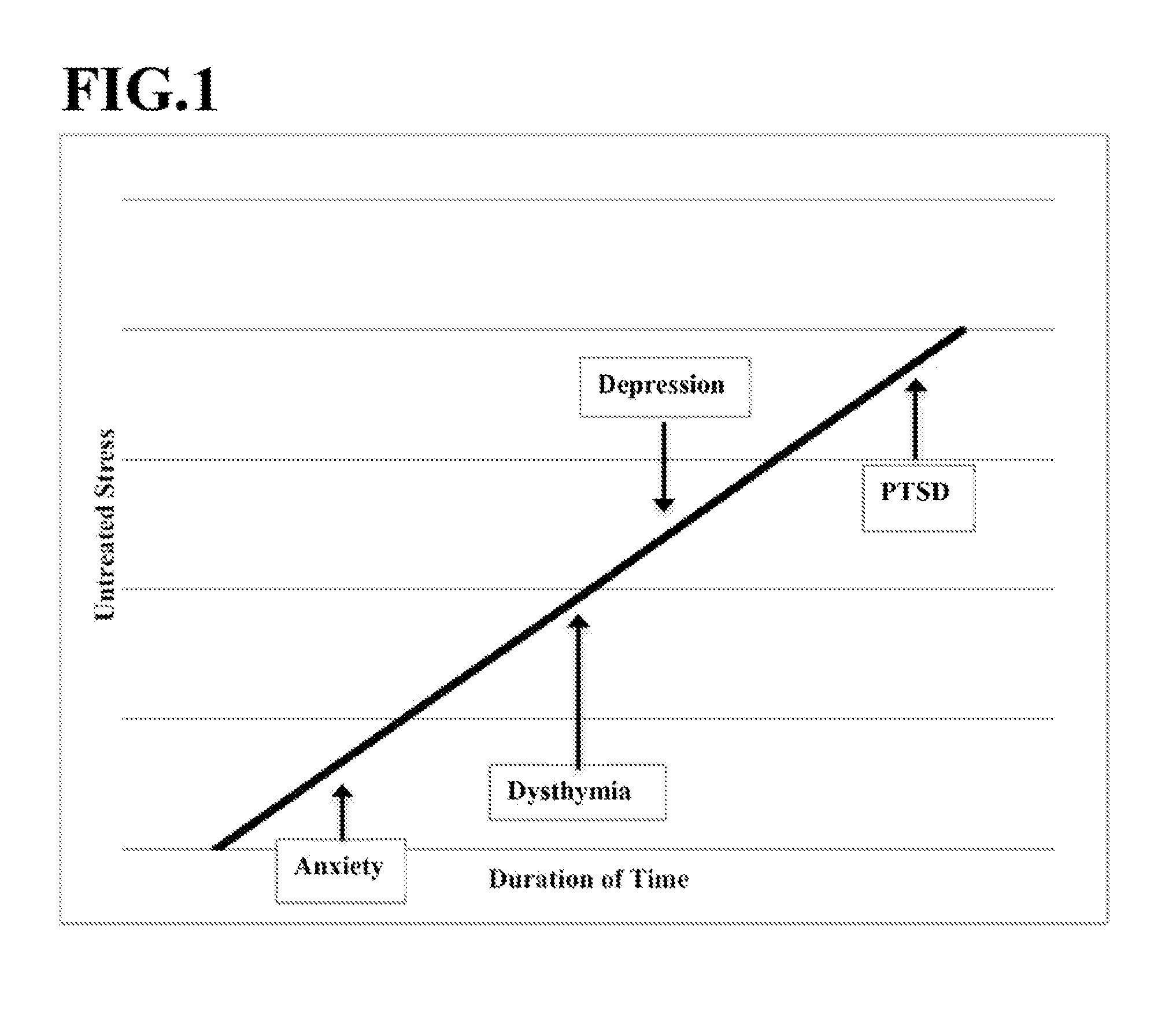

Cognitive biometric systems to monitor emotions and stress

ActiveUS20130281798A1ChangeElectroencephalographyElectrocardiographyObjective informationData transmission

The present invention provides methods and systems to periodically monitor the emotional state of a subject comprising the steps of: exposing the subject to a plurality of stimuli during a session; acquiring objective data from a plurality of monitoring sensors, wherein at least one sensor measures a physiological parameter; transferring the data to a database; and processing the data to extract objective information about the emotional state of the subject.

Owner:SACKETT SOLUTIONS & INNOVATIONS

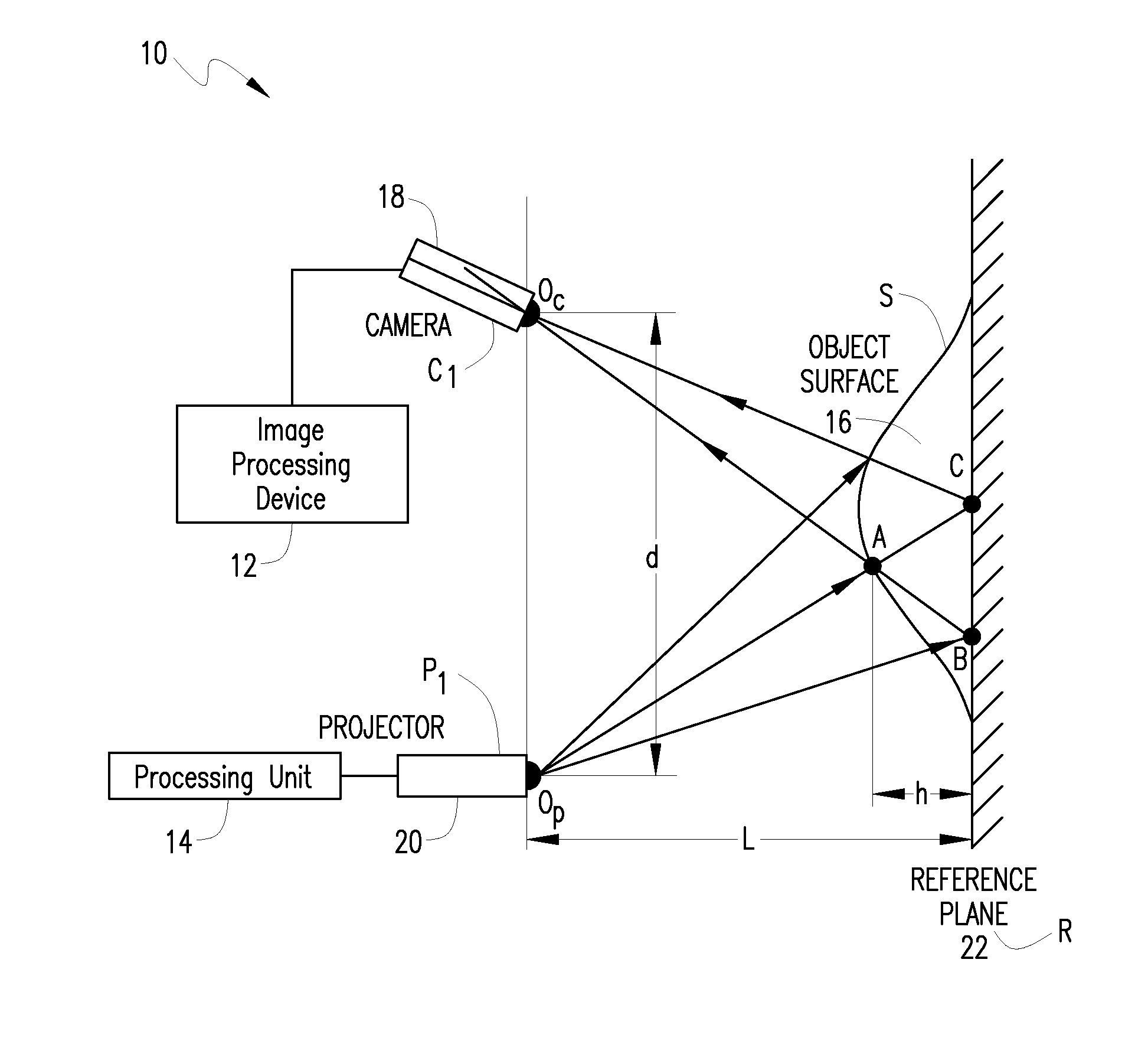

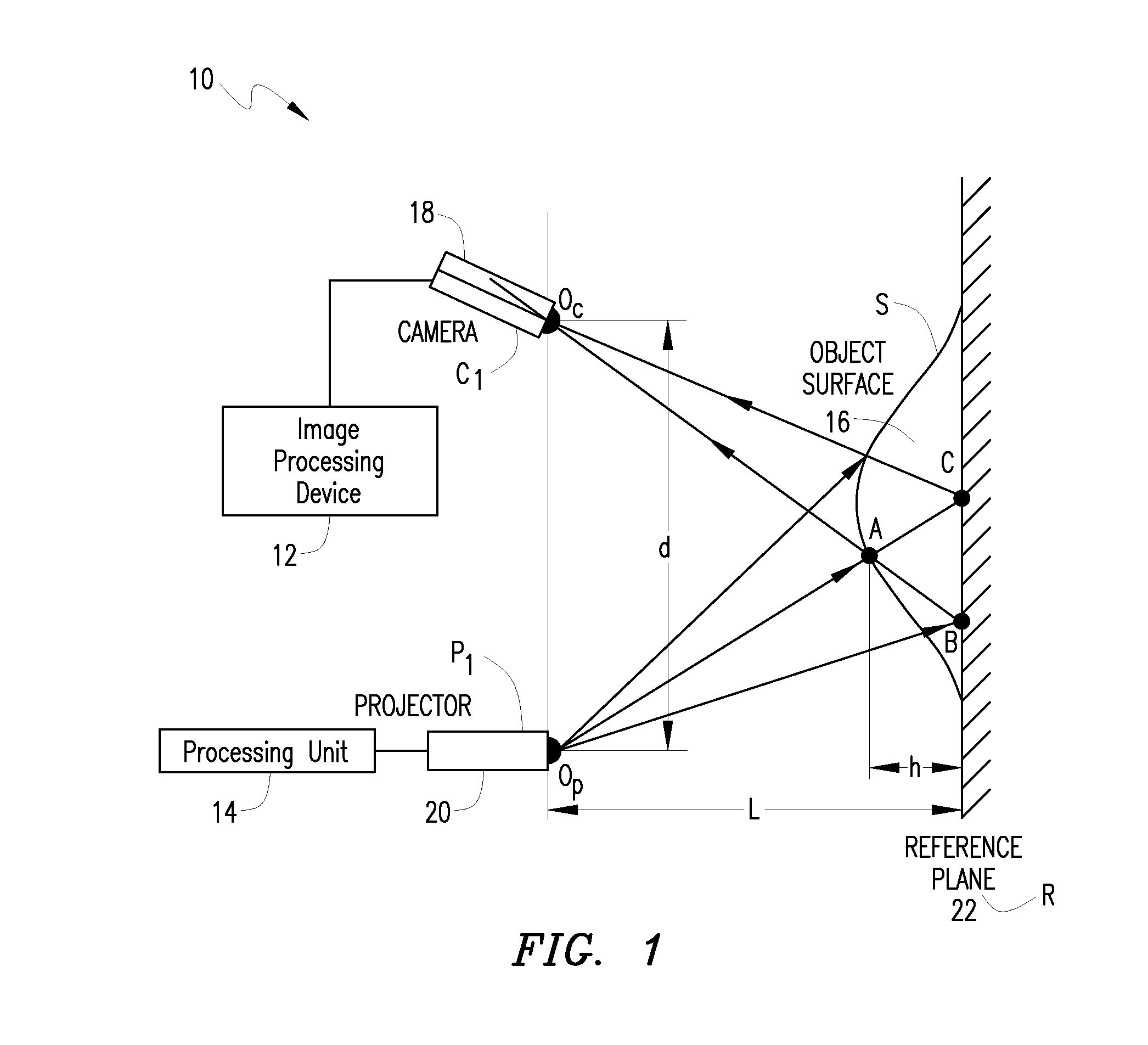

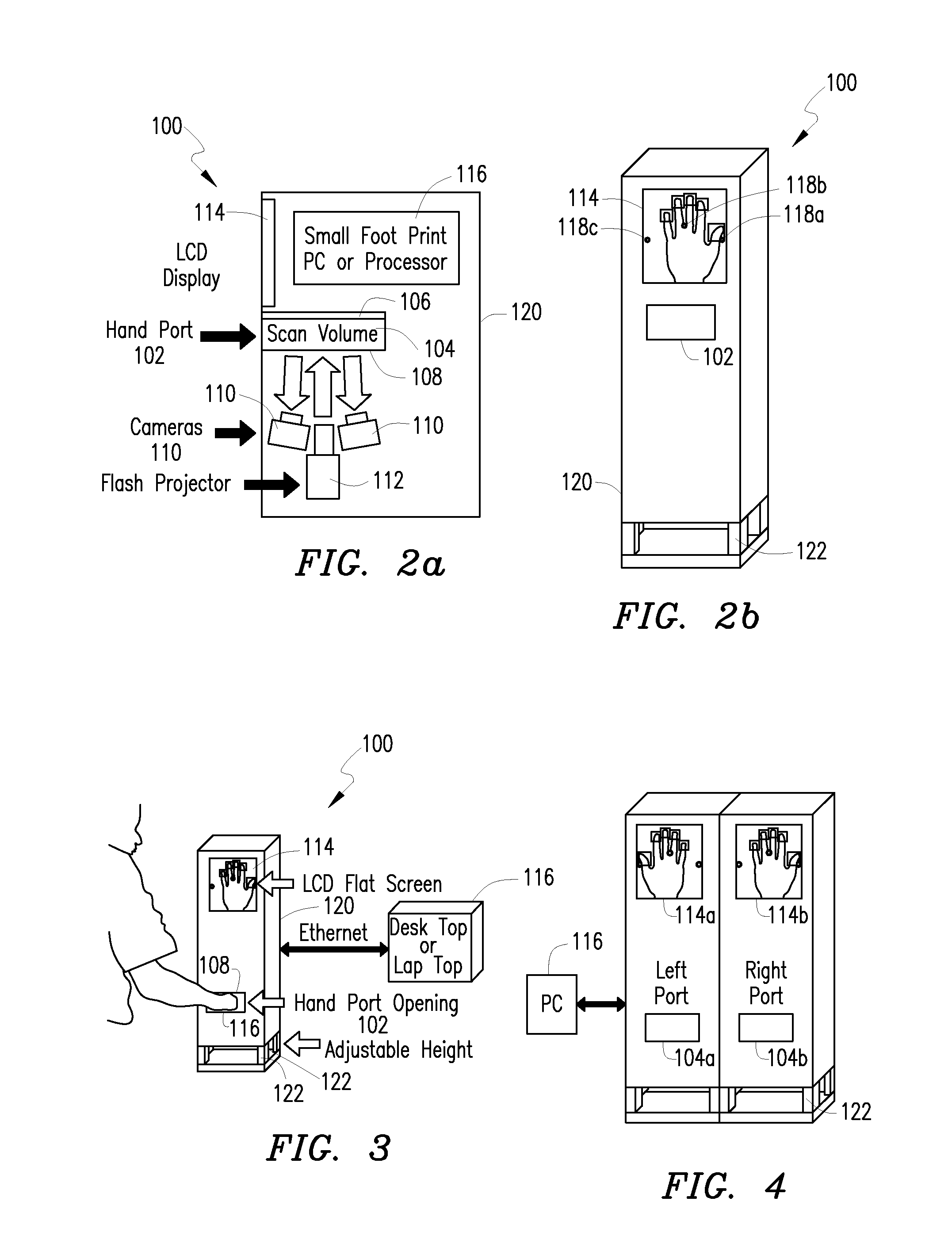

System and method for 3D imaging using structured light illumination

InactiveUS8224064B1Acquisition speed is fastMore robust to extremely worn ridges of the fingersImage enhancementImage analysisRandom noiseComputer science

A biometrics system captures and processes a handprint image using a structured light illumination to create a 2D representation equivalent of a rolled inked handprint. The biometrics system includes an enclosure with a scan volume for placement of the hand. A reference plane with a backdrop pattern forms one side of the scan volume. The backdrop pattern is preferably a random noise pattern and the coordinates of the backdrop pattern are predetermined at system provisioning. The biometrics system further includes at least one projection unit for projecting a structured light pattern onto a hand positioned in the scan volume on or in front of the backdrop pattern and at least two cameras for capturing a plurality of images of the hand, wherein each of the plurality of images includes at least a portion of the hand and the backdrop pattern. A processing unit calculates 3D coordinates of the hand from the plurality of images using the predetermined coordinates of the backdrop pattern to align the plurality of images and mapping the 3D coordinates to a 2D flat surface to create a 2D representation equivalent of a rolled inked handprint. The processing unit can also adjust calibration parameters for each hand scan from calculating coordinates of the portion of backdrop pattern in the at least one image and comparing with the predetermined coordinates of the backdrop pattern.

Owner:UNIV OF KENTUCKY RES FOUND

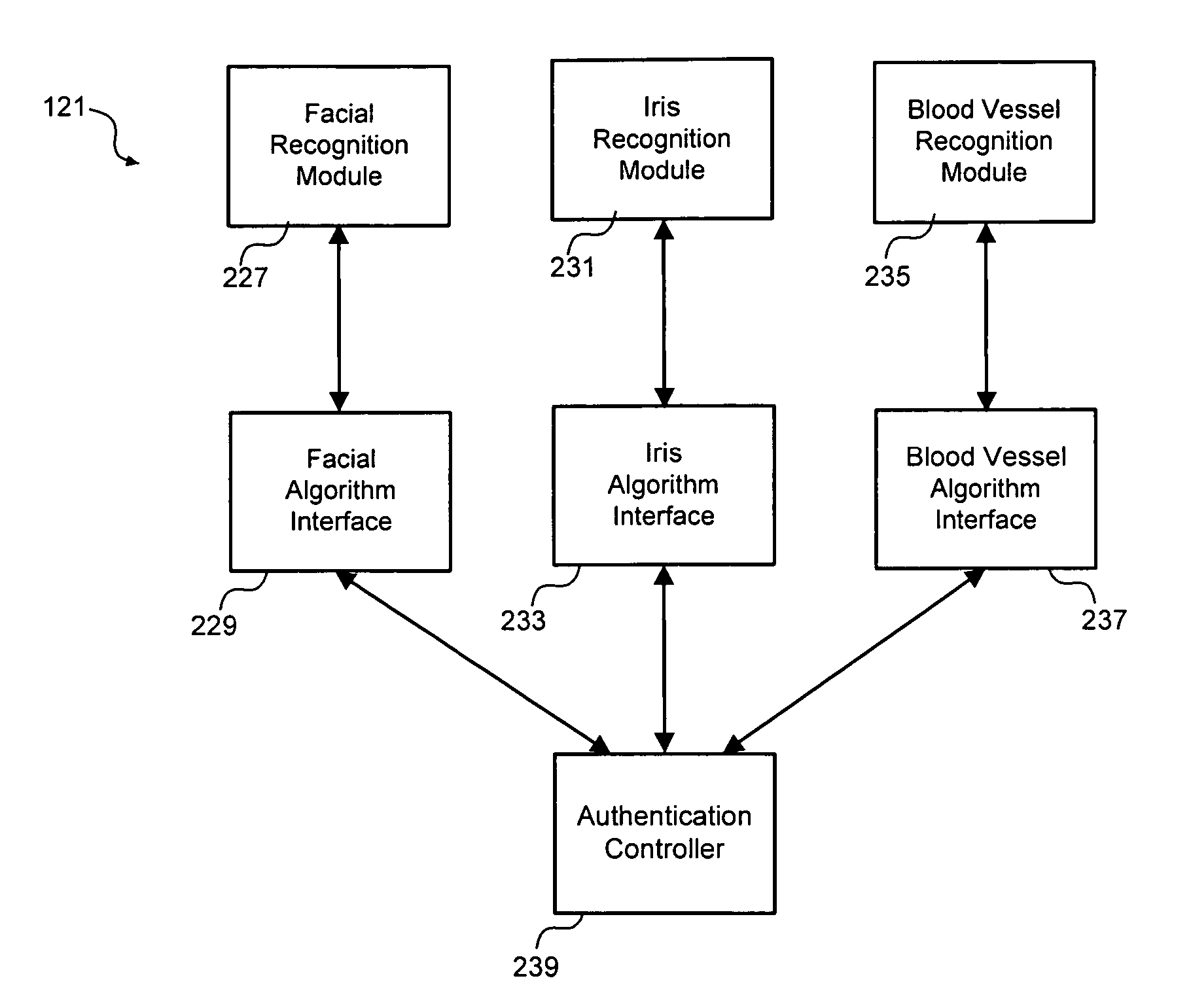

Biometric Identification Systems and Methods

An exemplary embodiment of the present invention provides a method of verifying an identity of a person-to-be-identified using biometric signature data. The method comprises creating a sample database based on biometric signature data from a plurality of individuals, calculating a feature database by extracting selected features from entries in the sample database, calculating positive samples and negative sampled based on entries in the feature database, calculating a key bin feature using an adaptive boosting learning algorithm, the key bin feature distinguishing each of the positive samples and negative samples, and calculating a classifier from the key bin feature for use in identifying and authenticating a person-to-be-identified.

Owner:STONE LOCK GLOBAL INC

Multimodal biometric analysis

ActiveUS7362884B2Electric signal transmission systemsImage analysisPattern recognitionBiometric system

A biometric system that uses readings from a plurality of biometrics of a user is disclosed. The biometric system includes a first and second biometric readers, a first and second biometric matching engines and a processor. The first biometric reader producing a first measured biometric that is processed by the first biometric matching engine to deliver a first value, which is indicative of a likelihood that the first measured biometric matches a first stored biometric reading. A plurality of first values are gathered prior to the first value. The second biometric reader delivers a second measured biometric for processing by the second biometric matching engine to produce a second value, which is indicative of a likelihood that the second measured biometric matches a second stored biometric reading. A plurality of second values are gathered prior to the second value. The first and second biometric readers measure a different biometric, or the first and second biometric matching engines use a different algorithm. The processor normalizes the first value according to the plurality of first values, normalizes the second value according to the plurality of second values, and determines if the user matches a person using the normalized first and second values.

Owner:IMAGEWARE SYST

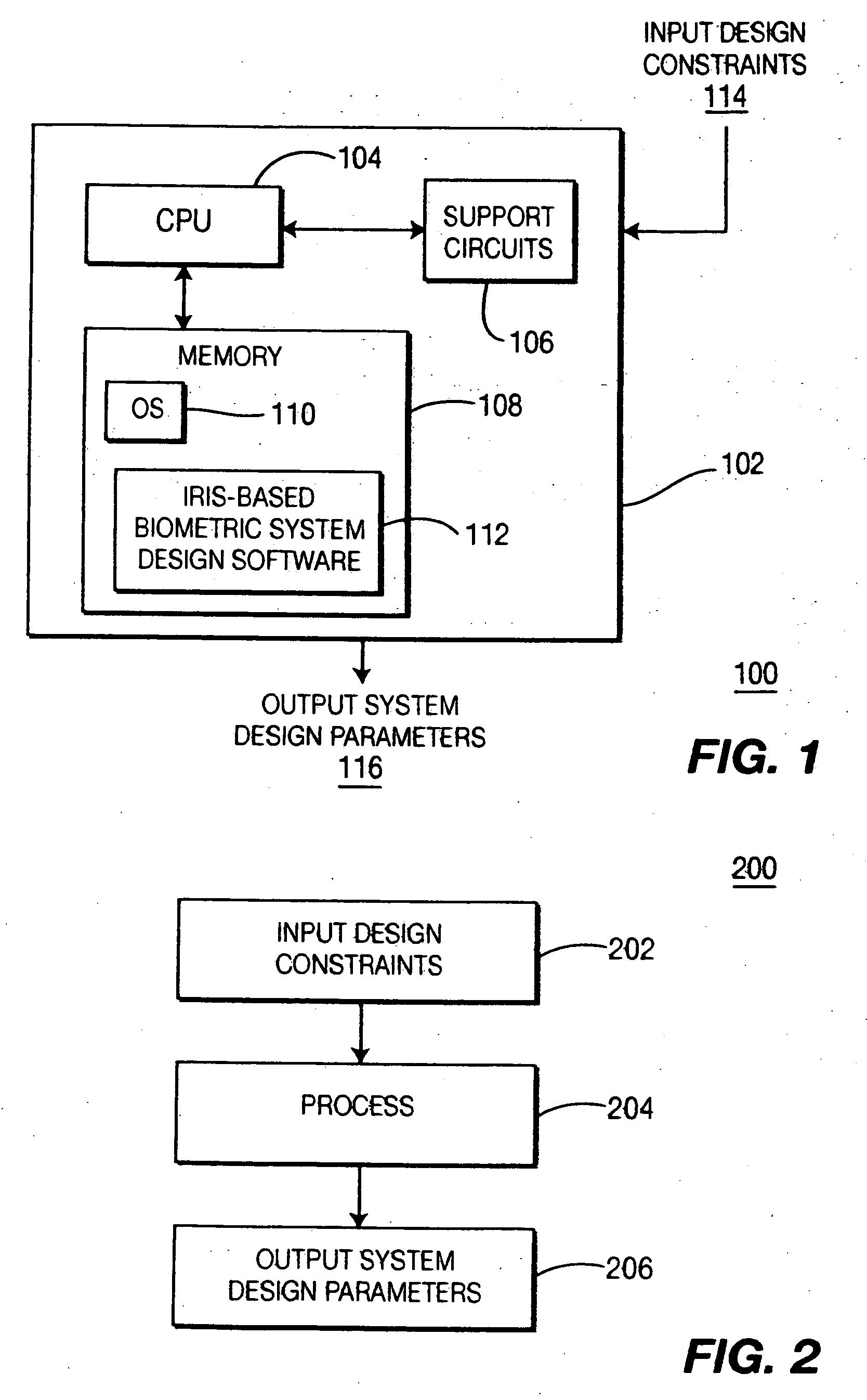

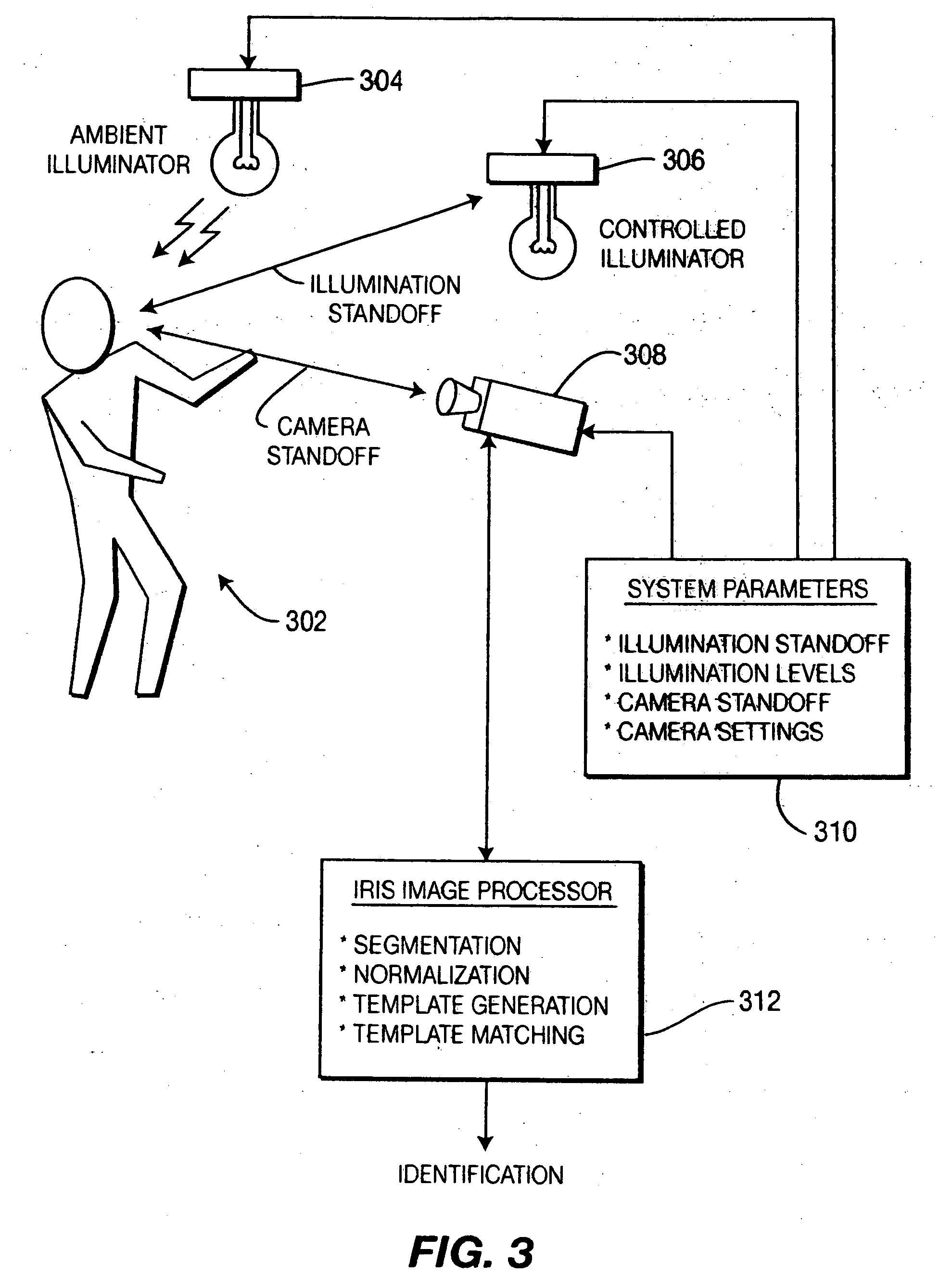

Method and apparatus for designing iris biometric systems for use in minimally constrained settings

A method and apparatus for designing an iris biometrics system that operates in minimally constrained settings. The image acquisition system has fewer constraints on subjects than traditional methods by extending standoff distance and capture volume. The method receives design parameters and provides derived quantities that are useful in designing an image acquisition system having a specific set of performance requirements. Exemplary scenarios of minimally constrained settings are provided, such as a high volume security checkpoint, an office, an aircraft boarding bridge, a wide corridor, and an automobile.

Owner:SARNOFF CORP

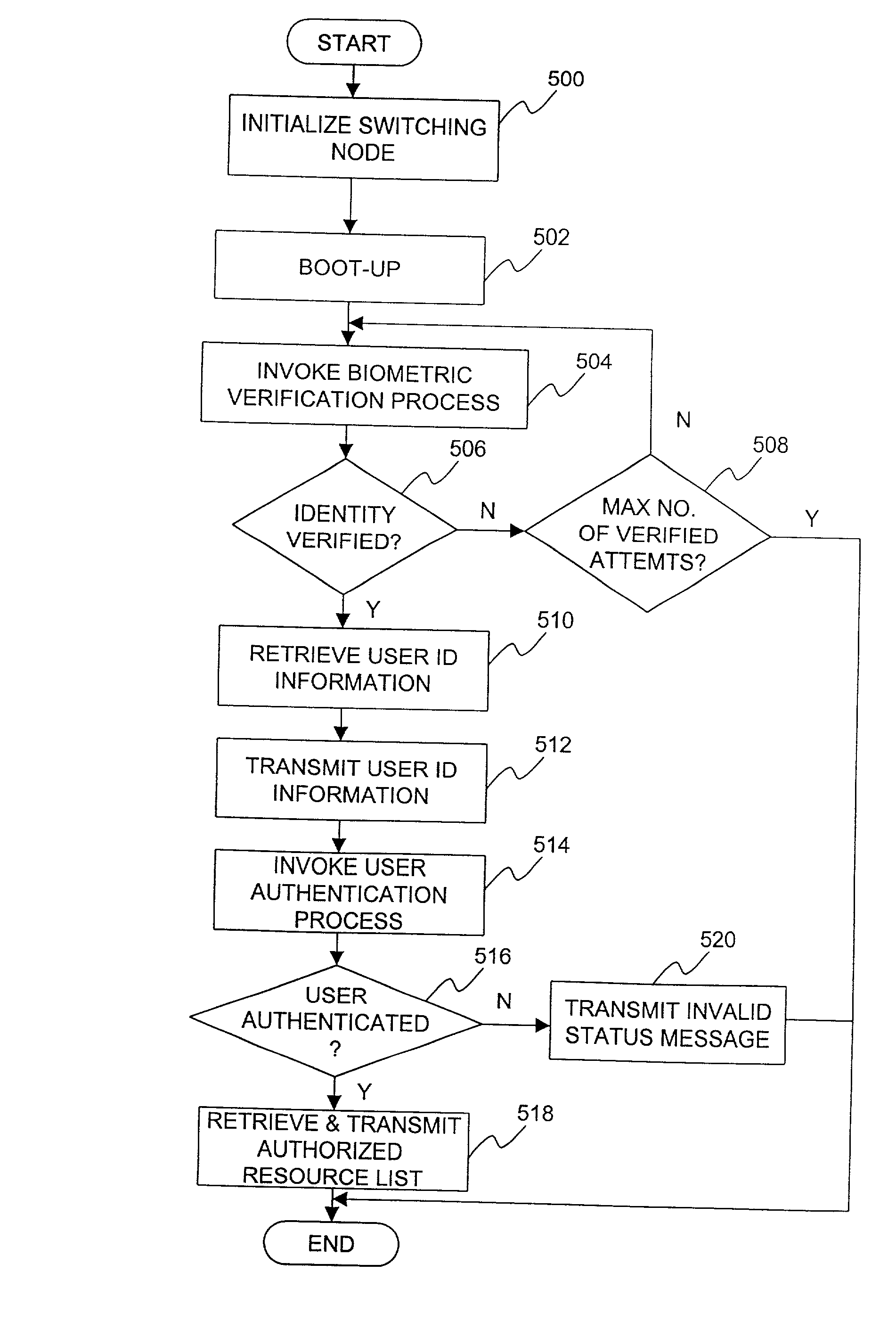

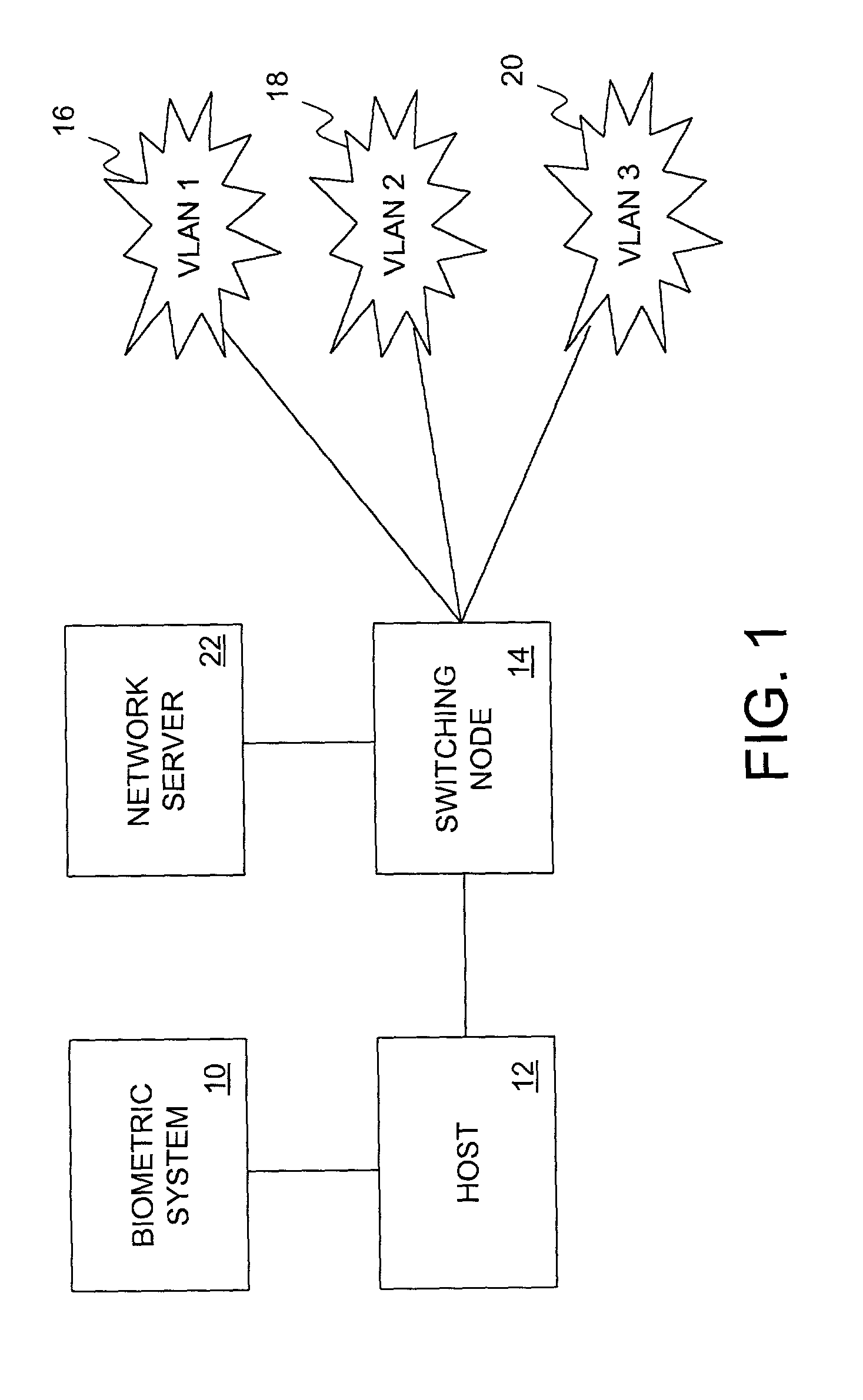

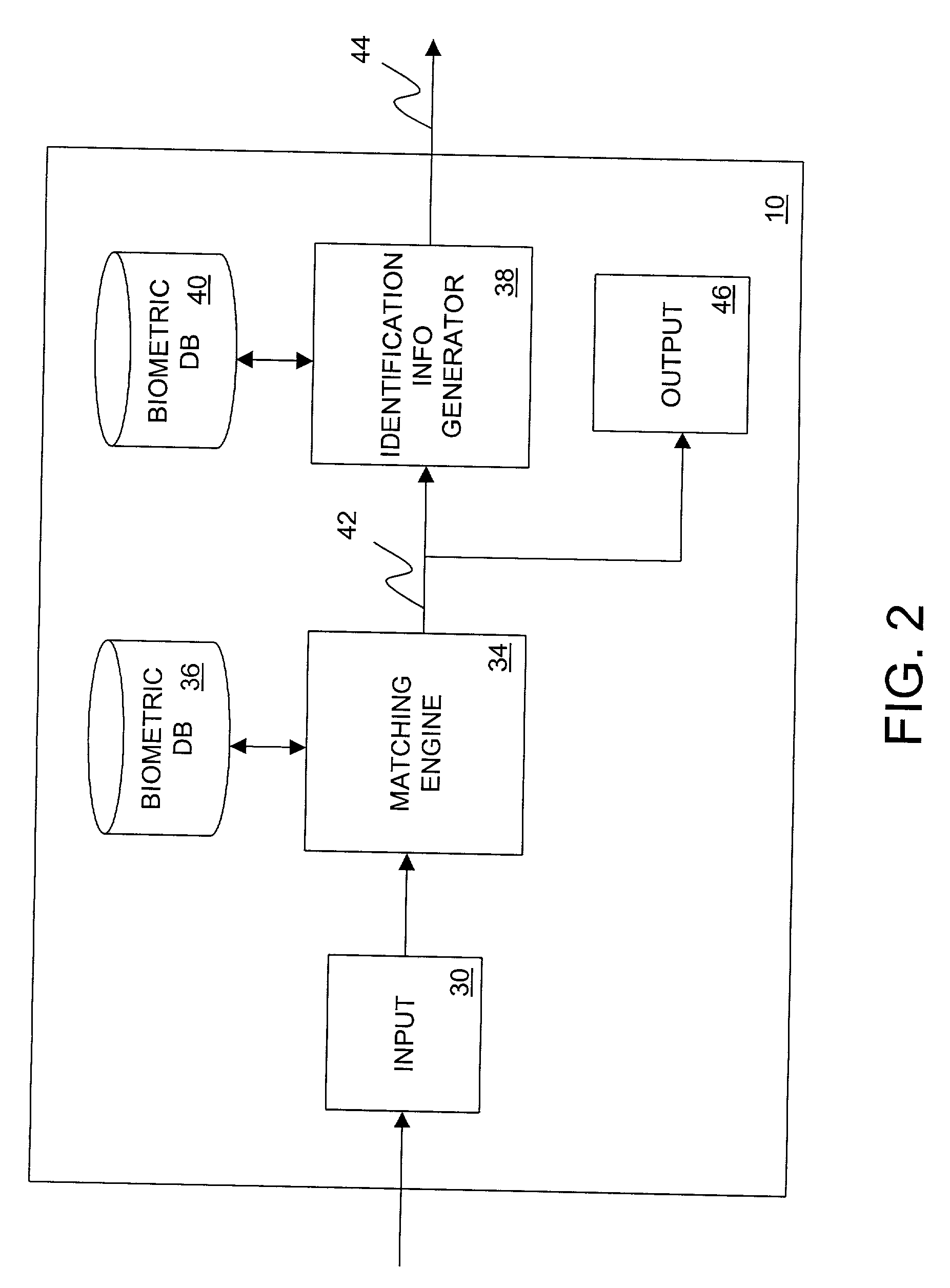

Biometric authenticated VLAN

InactiveUS20020129285A1Prevent illegal useUnauthorized useDigital data processing detailsUser identity/authority verificationInternet privacyUser authentication

A user authentication system and method for a data communication network that helps ensure that a user accessing the network resources is indeed the person having a claimed identity. The user's identity is verified by a biometric system by examining the user's physiological or behavioral characteristic. User identification information needed for accessing the network resources is stored in the biometric system and not released until the user's identity is verified. Upon verification of the user's identity, the user identification data is provided to a switching node for determining the VLANs that the user may access.

Owner:ALCATEL LUCENT SAS

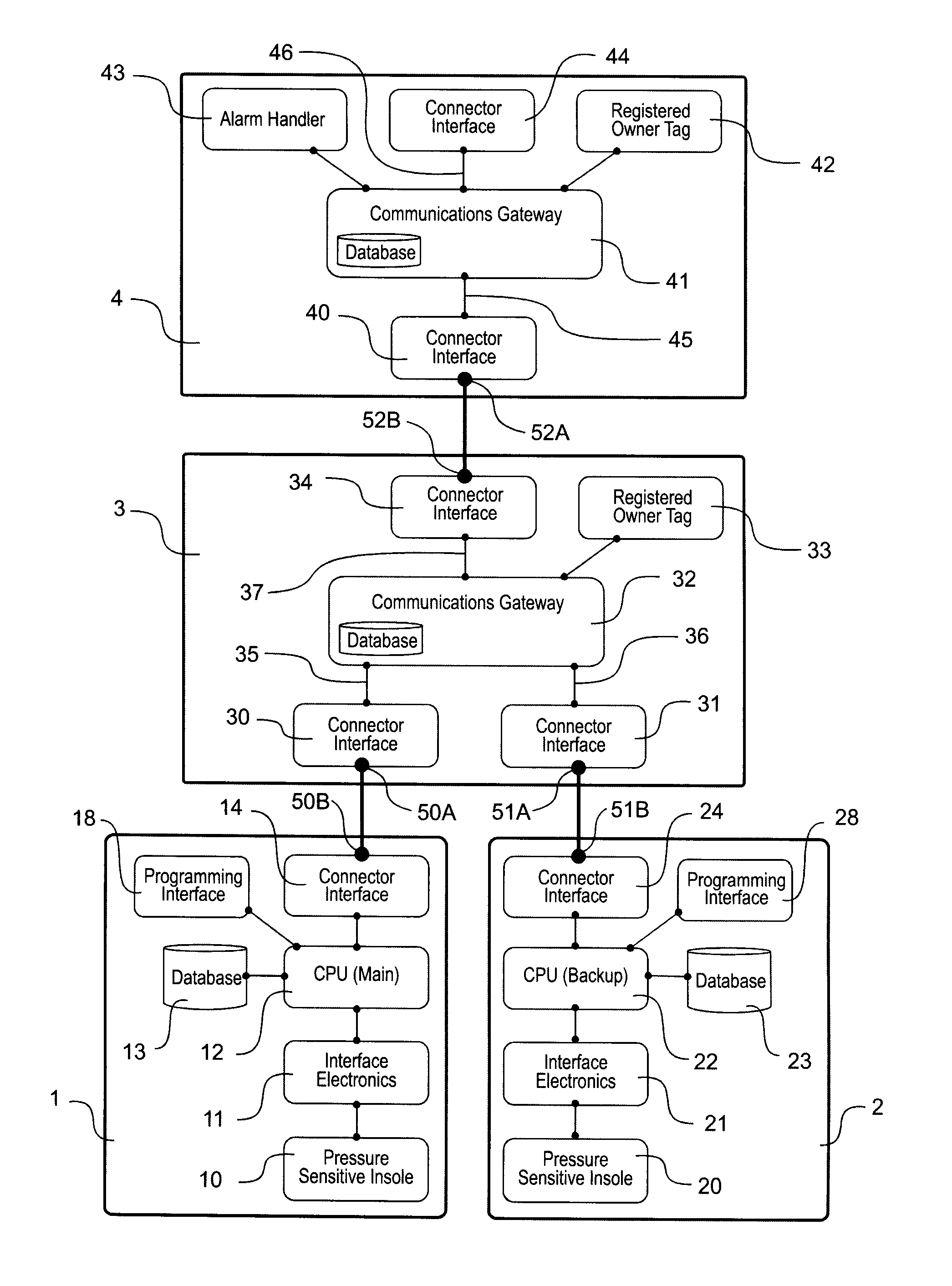

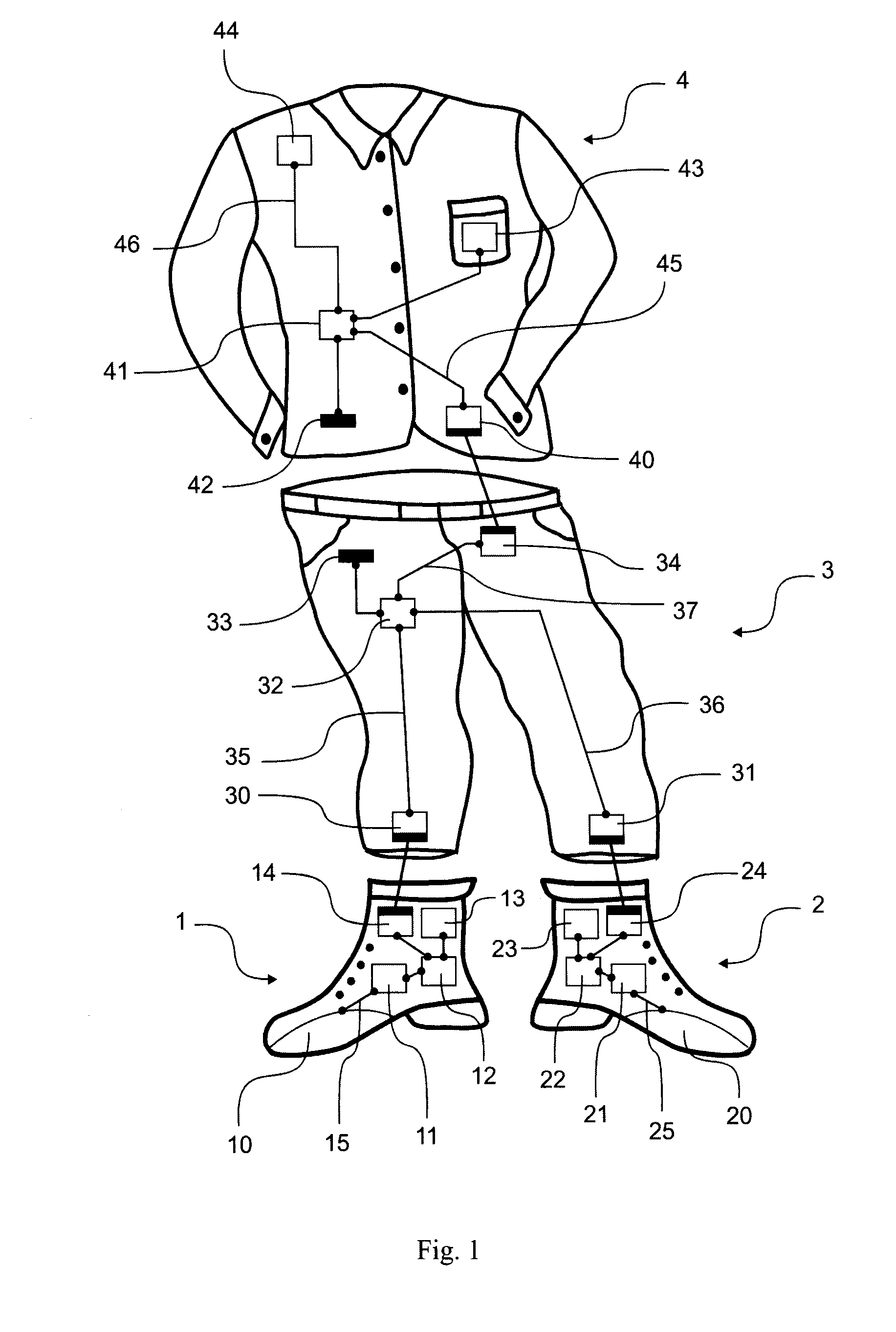

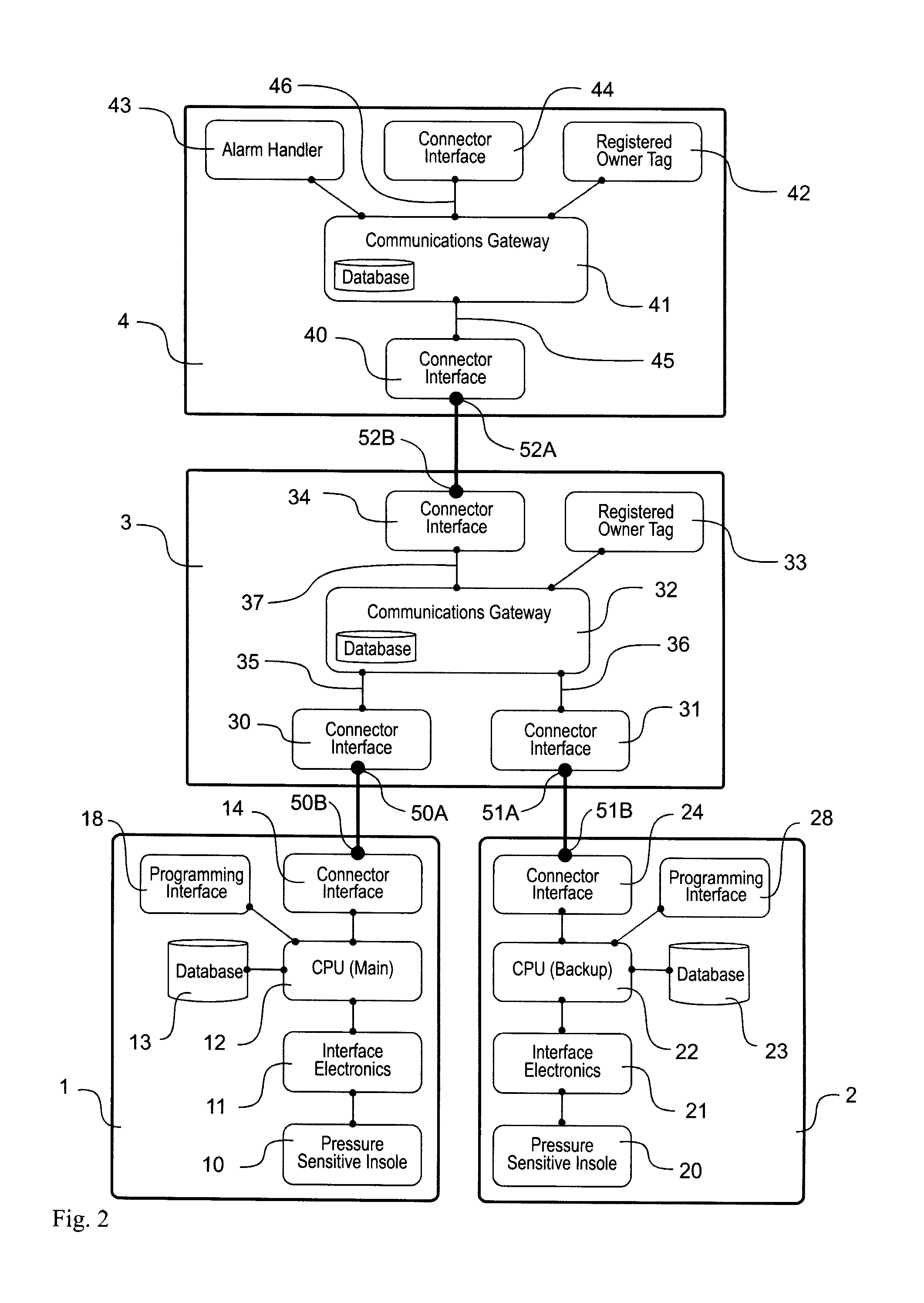

Pedobarographic biometric system

InactiveUS20120086550A1Electric signal transmission systemsDigital data processing detailsEngineeringBiometric system

A method and system to characterize the wearer of at least one item of footwear having a sensor means which, while the item is being worn, collects from the wearer current pedobarometric data that is characteristic of the wearer, and the current pedobarometric data is compared with corresponding reference data for a specified wearer, preferably previously collected via the same or a similar item of footwear while worn by the specified wearer under controlled conditions, the results of the comparison being used to characterize the present wearer according to prescribed criteria.

Owner:LEBLANC DONALD JOSEPH +2

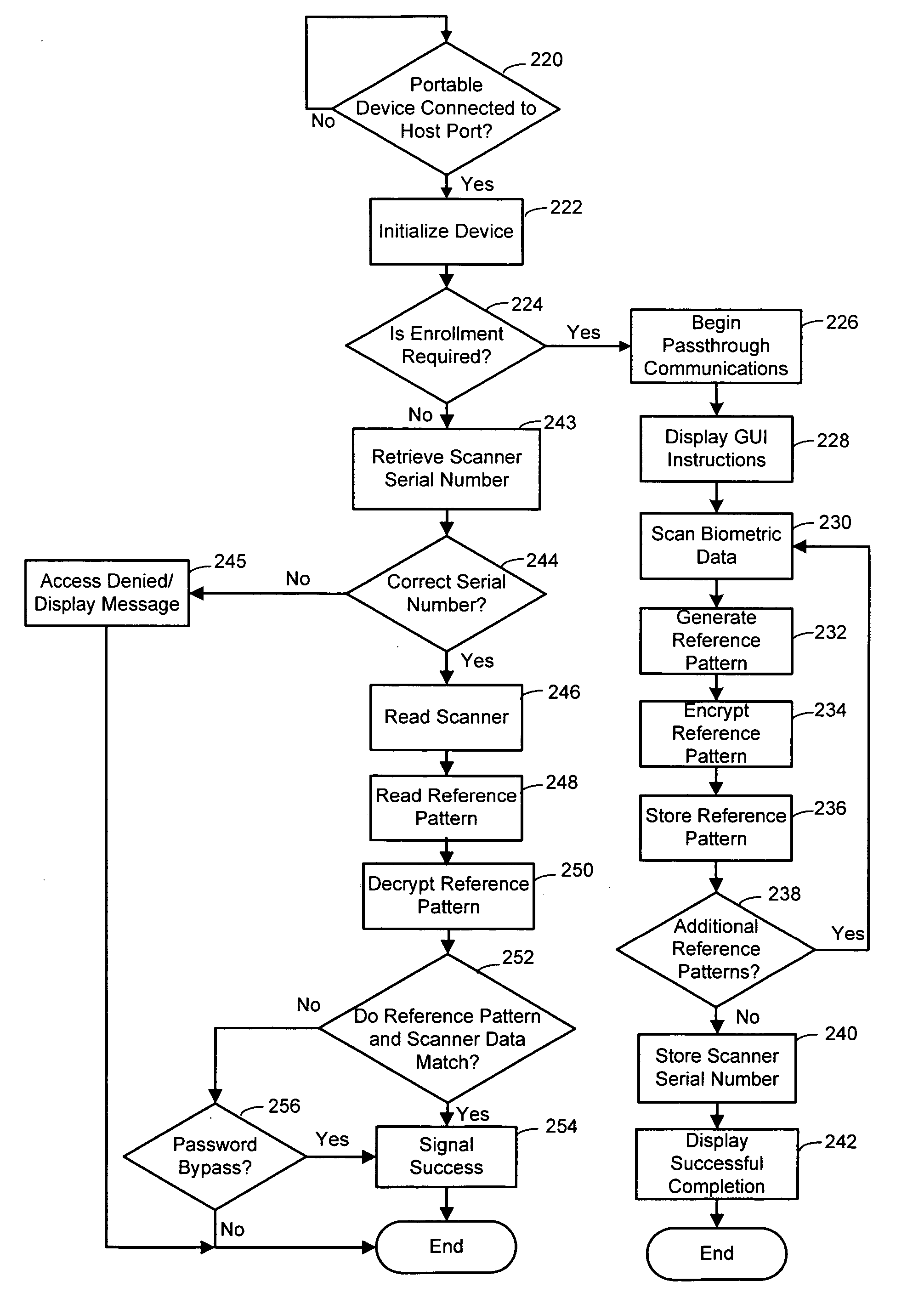

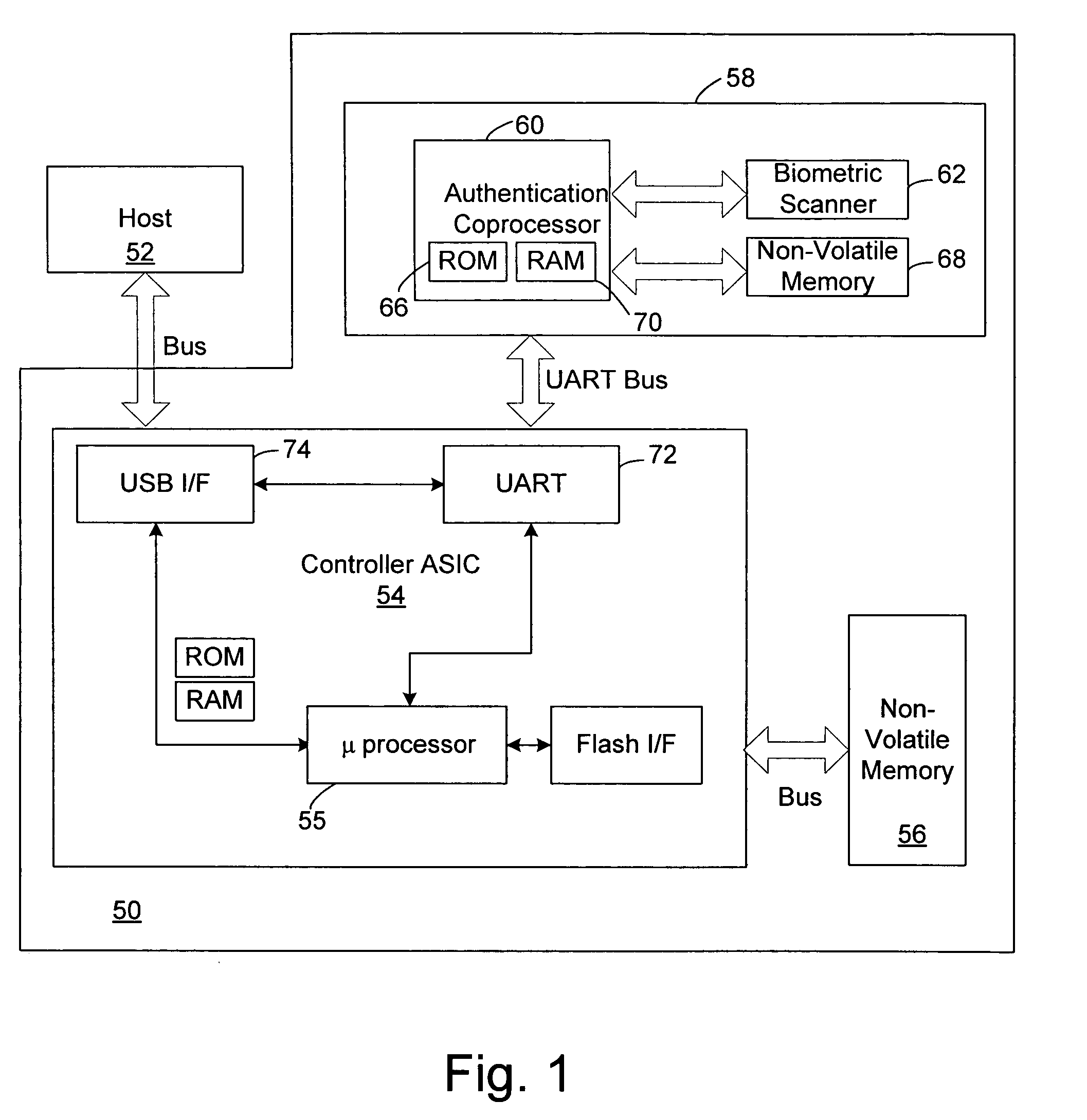

Portable memory storage device with biometric identification security

ActiveUS20060204047A1Easy accessSmall sizeElectric signal transmission systemsImage analysisBiometric dataUSB

A portable memory storage device is disclosed where access to information on the device is granted only upon proper biometric authentication of a user. The device includes a controller, a non-volatile memory which may be a flash memory, and a biometric scanner system for controlling access to the information within the non-volatile memory. Each of the controller, non-volatile memory and biometric scanner system may be mounted in a base of the portable device, with the biometric system having an exposed surface on a top portion of the base for accepting biometric data such as a fingerprint. A cover is provided which includes a USB connector capable of mating within a USB port of the host device to establish communications between the portable and host devices. The cover also covers the exposed portion of the biometric scanner to protect the sensor when the portable memory storage device is not in use.

Owner:SANDISK TECH LLC

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com