Patents

Literature

1131 results about "Bank account" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

Electronic game system, method of managing and regulating said system

InactiveUS6117011AImprove securityAvoid possibilityComputer controlSimulator controlSecure communicationAutomatic control

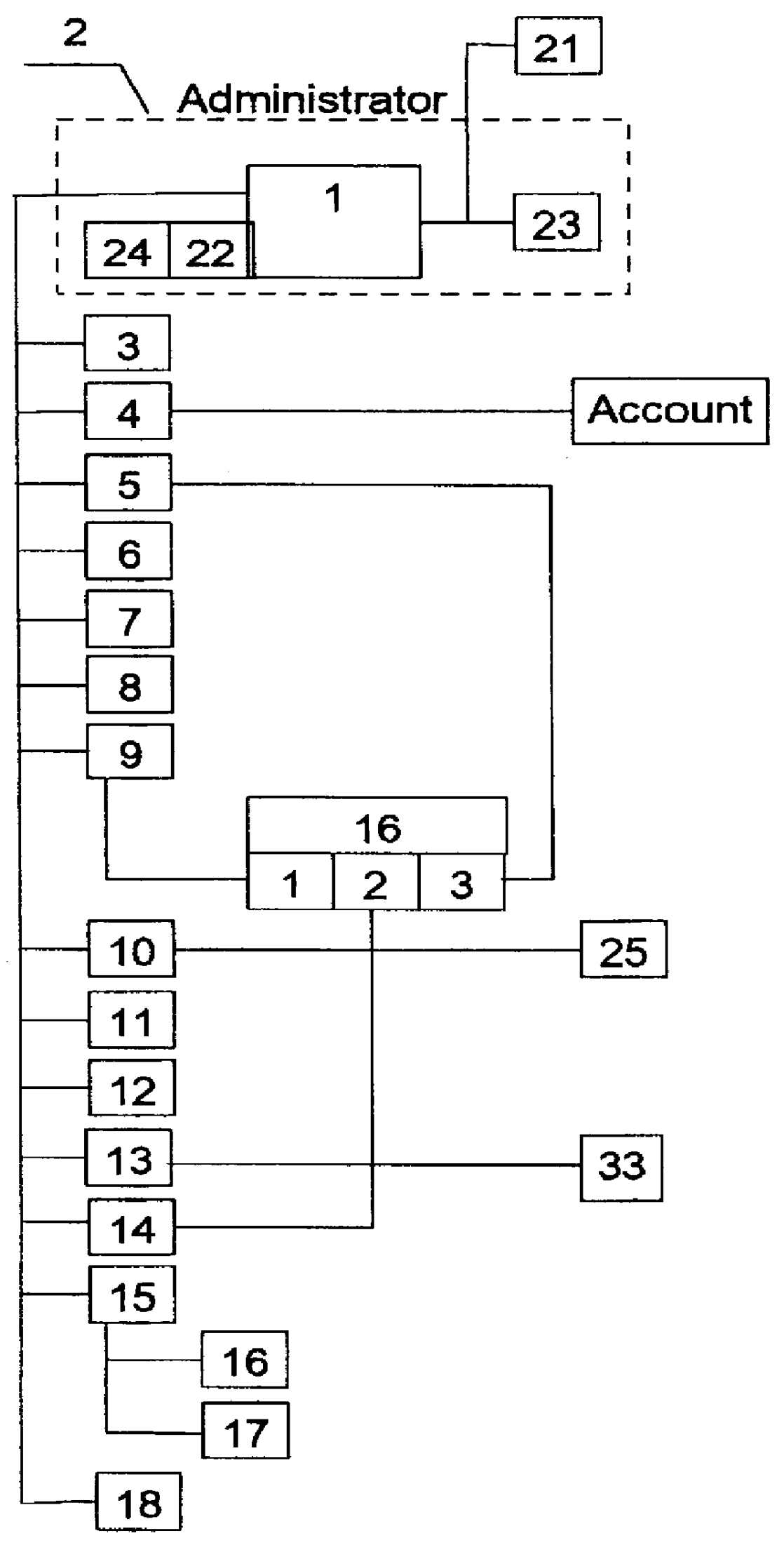

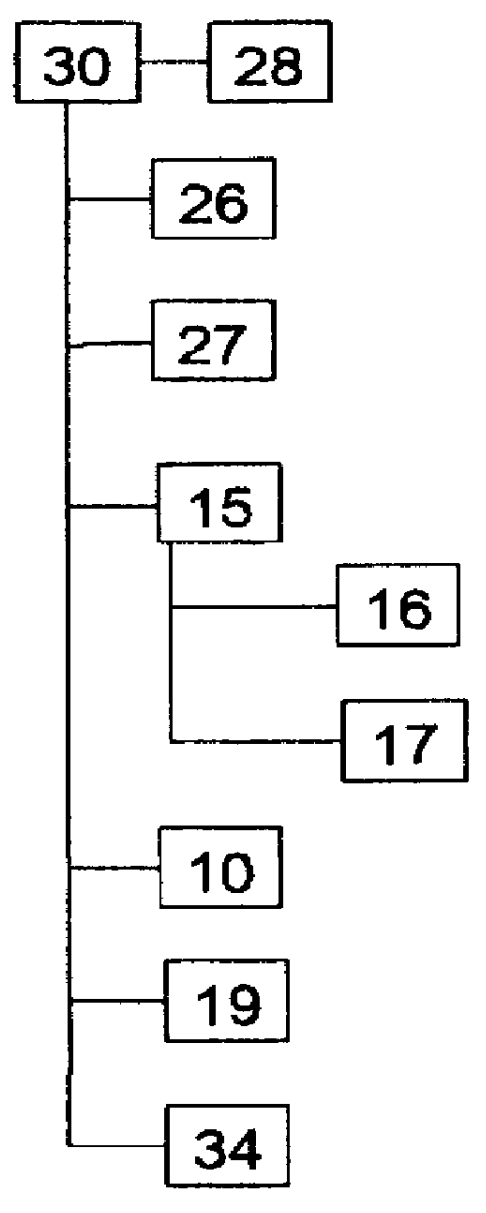

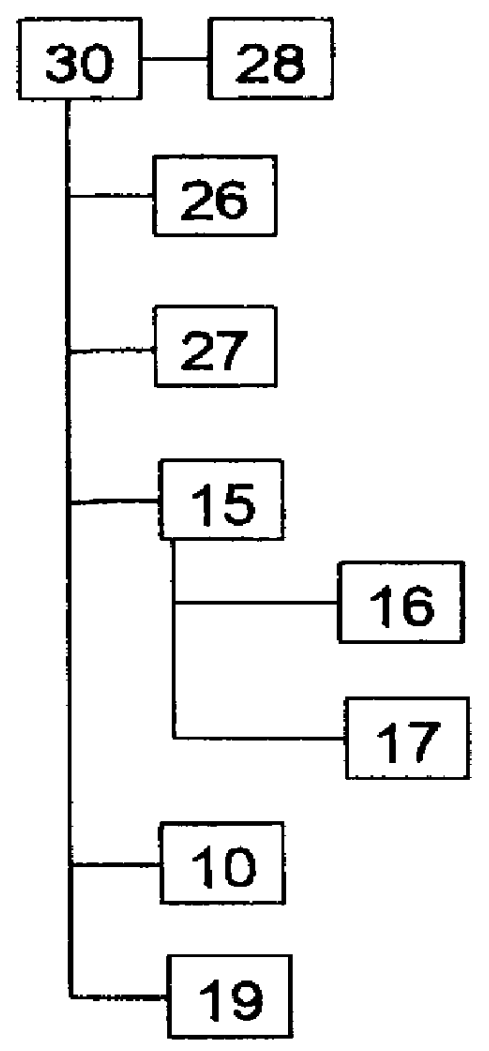

PCT No. PCT / RU95 / 00241 Sec. 371 Date Jan. 27, 1998 Sec. 102(e) Date Jan. 27, 1998 PCT Filed Nov. 10, 1995 PCT Pub. No. WO97 / 05557 PCT Pub. Date Feb. 13, 1997An electronic gaming system is disclosed that includes a central computer station, a plurality of peripheral computer stations, and a data exchange network for coupling the peripheral computer stations to the central computer station. The central computer station includes an administrative subsystem, a player's registration subsystem, a game accounts managing subsystem, an information tabulating, storing and searching subsystem, a game recording subsystem, a scoring subsystem, a wagering and betting subsystem, an executive gaming subsystem, an electronic payment subsystem, an information protection subsystem, a secure communications subsystem, and a game selection subsystem. Each of the peripheral computer stations include a subsystem for admitting and registering players with the central computer station and a gaming interface subsystem. To ensure security of the electronic gaming system, a player seeking to enter the system transmits an encoded message from their peripheral computer station to the central computer station that includes a set of key attributes associated with the player. The central computer station decodes and compares the transmitted set of key attributes with individual information previously stored in the information protection subsystem in order to identify each player during registration based upon the set of key attributes transmitted by each player. The system may automatically control money transactions with each player's bank accounts based upon the player's scoring and wagers in each selected game.

Owner:LYDIA VLADIMIROVNA NESTERENKO

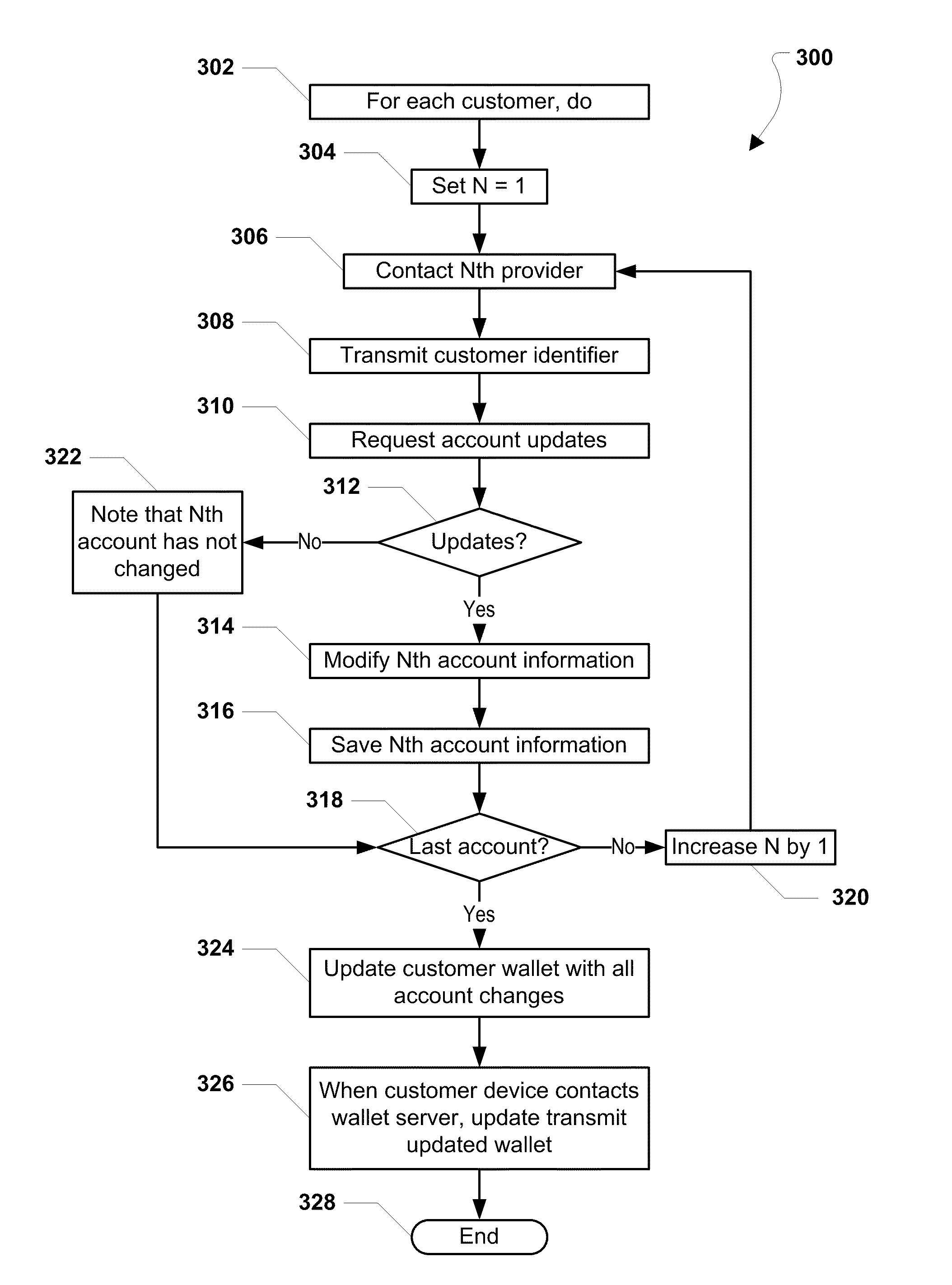

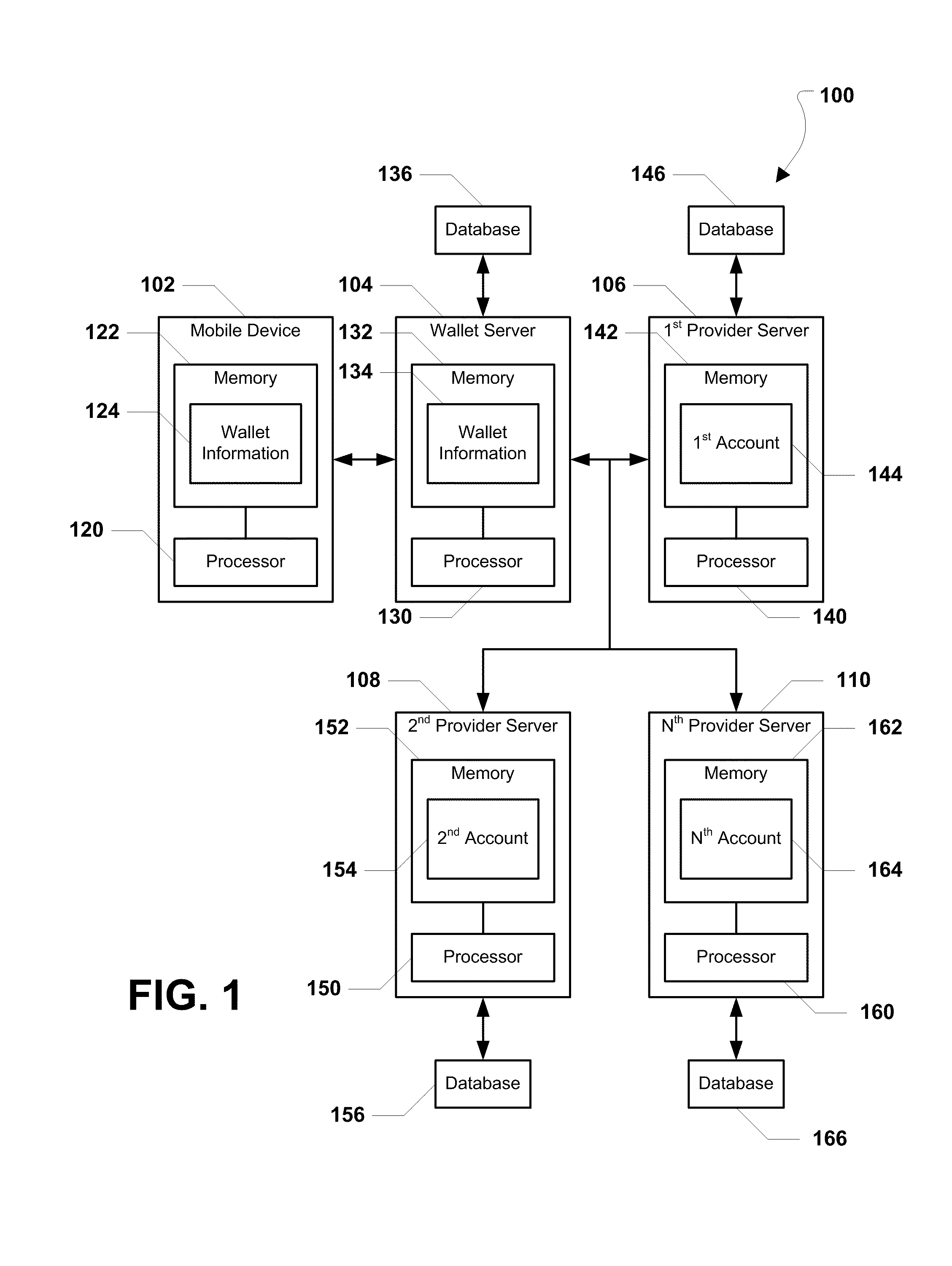

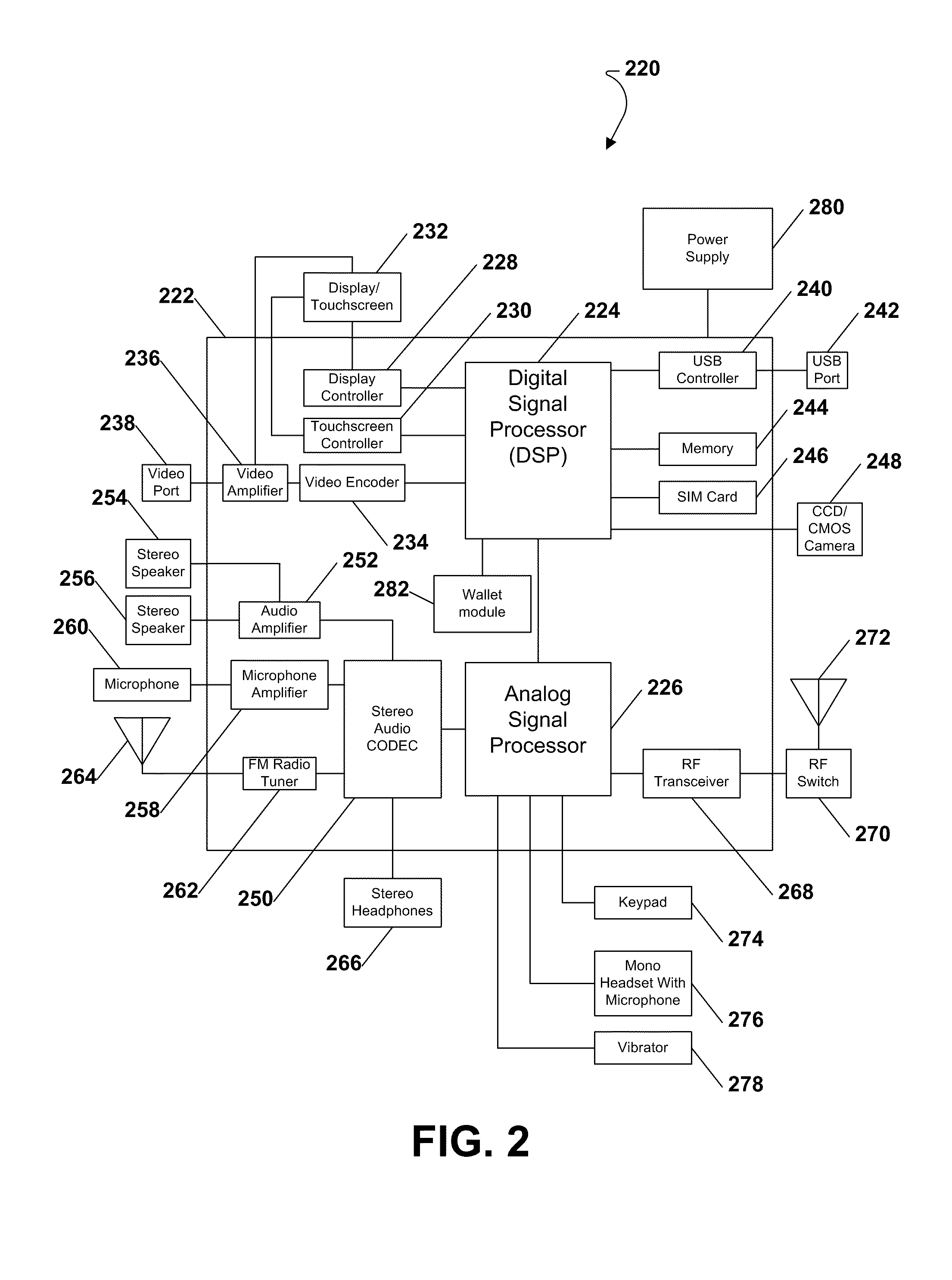

System and method of providing a mobile wallet at a mobile telephone

A method of providing a mobile wallet is disclosed and may include displaying a mobile wallet login screen and displaying a mobile wallet. The mobile wallet includes at least one of the following: an accounts option, a buy now option, an offers option, a receipts option, and a more option. The method further includes displaying one or more accounts when the accounts option is selected. The one or more accounts may include at least one of the following: a bank account, a credit account, a gift card account, and a rewards account.

Owner:QUALCOMM INC

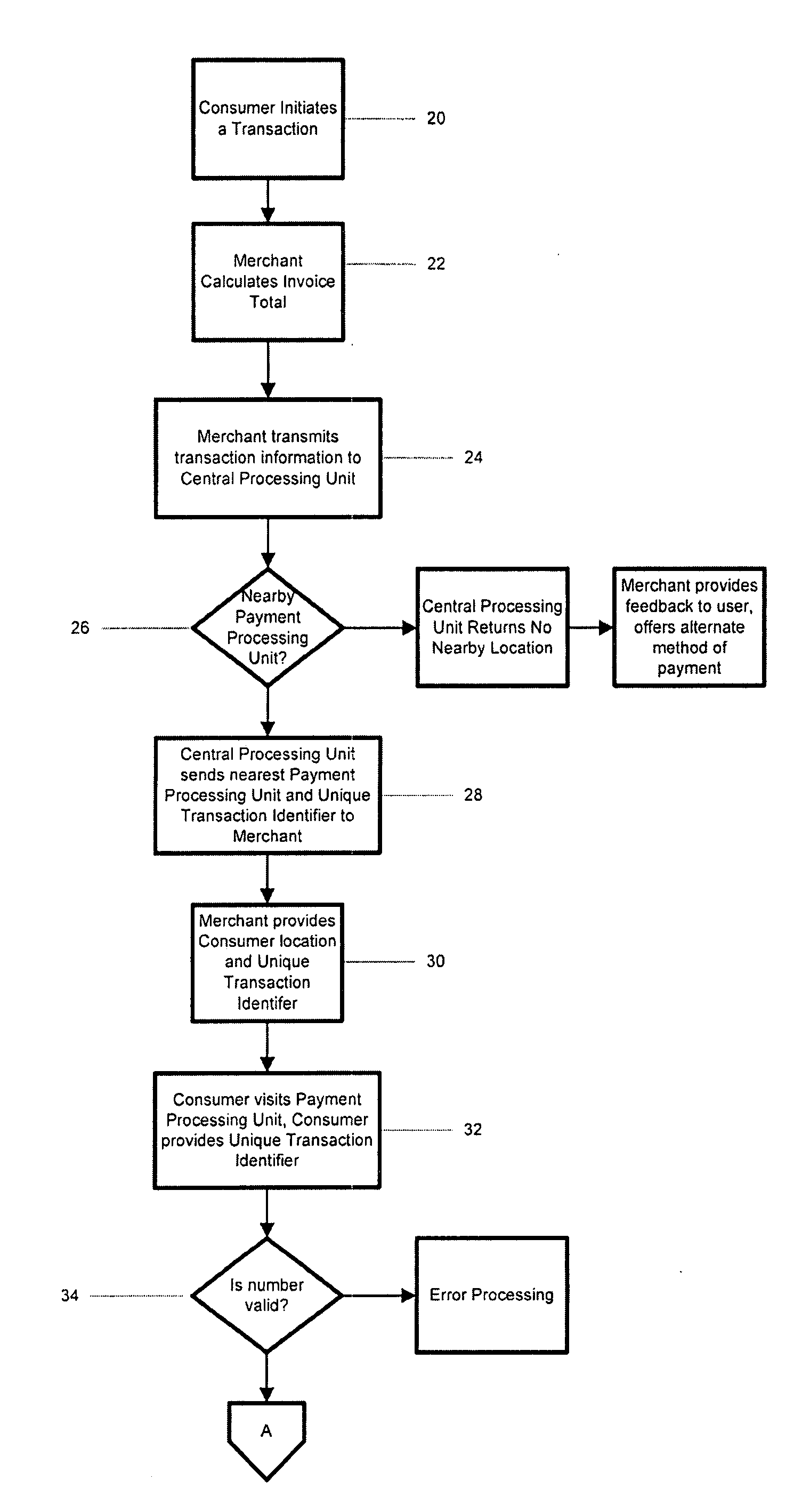

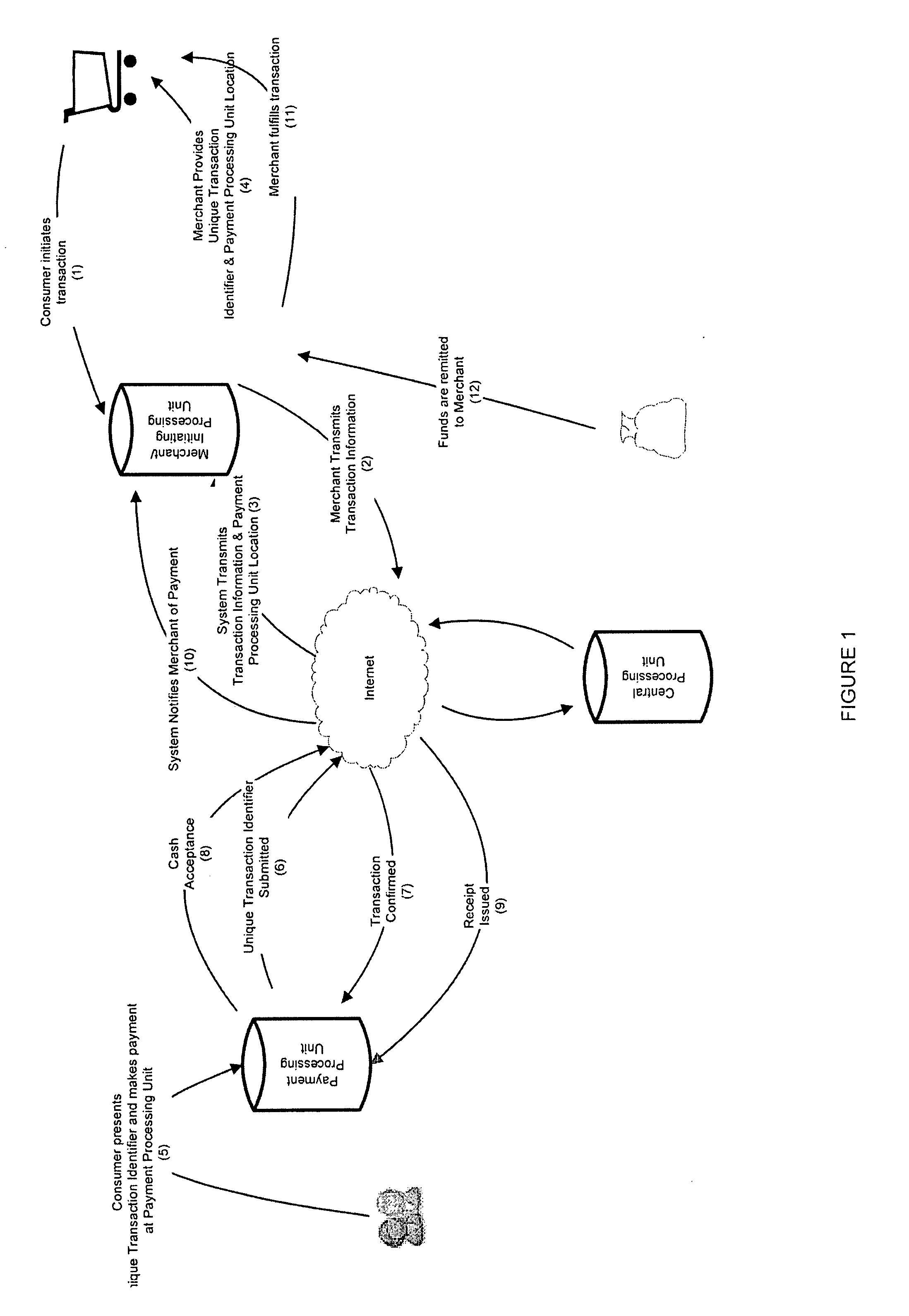

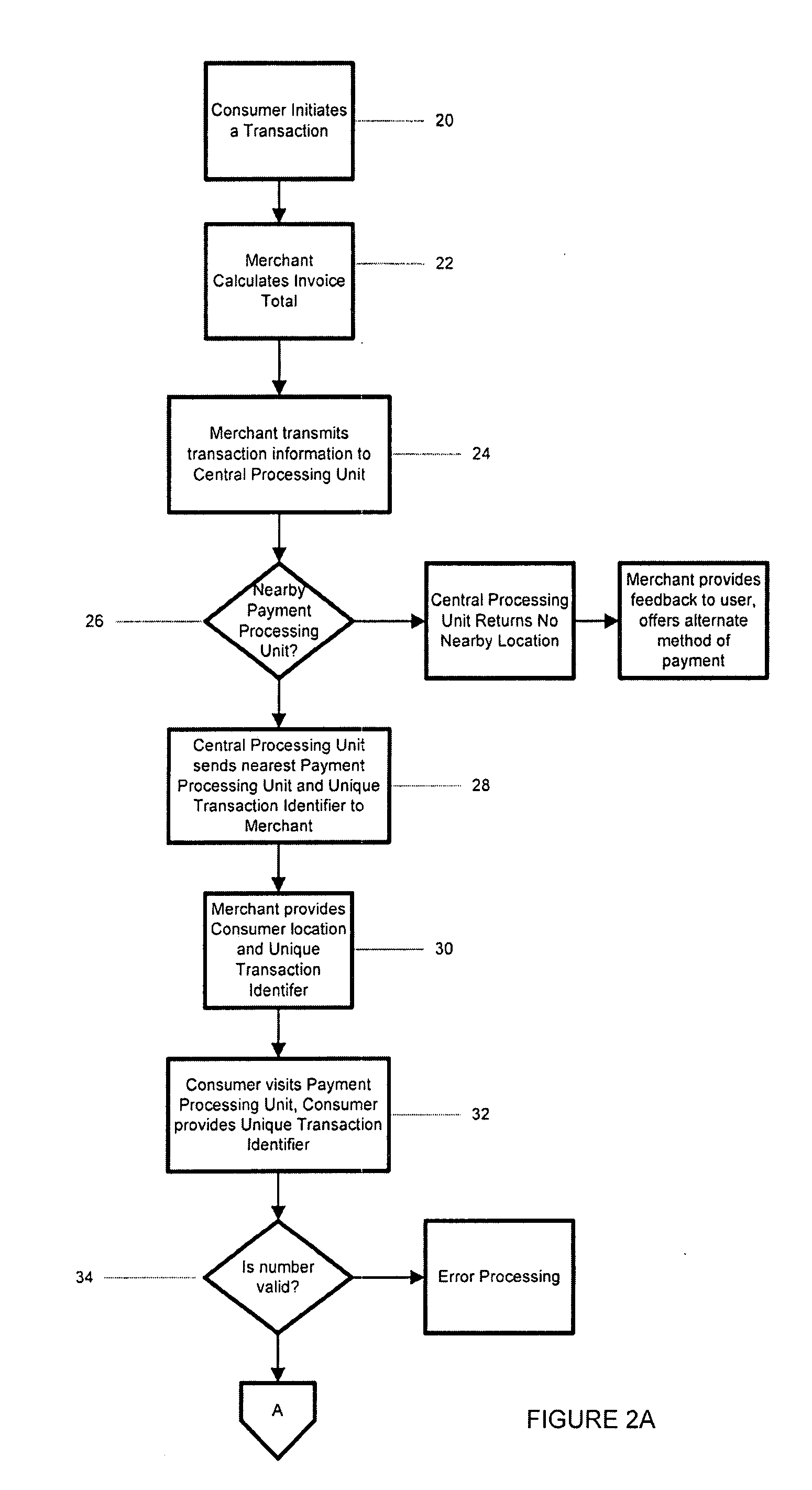

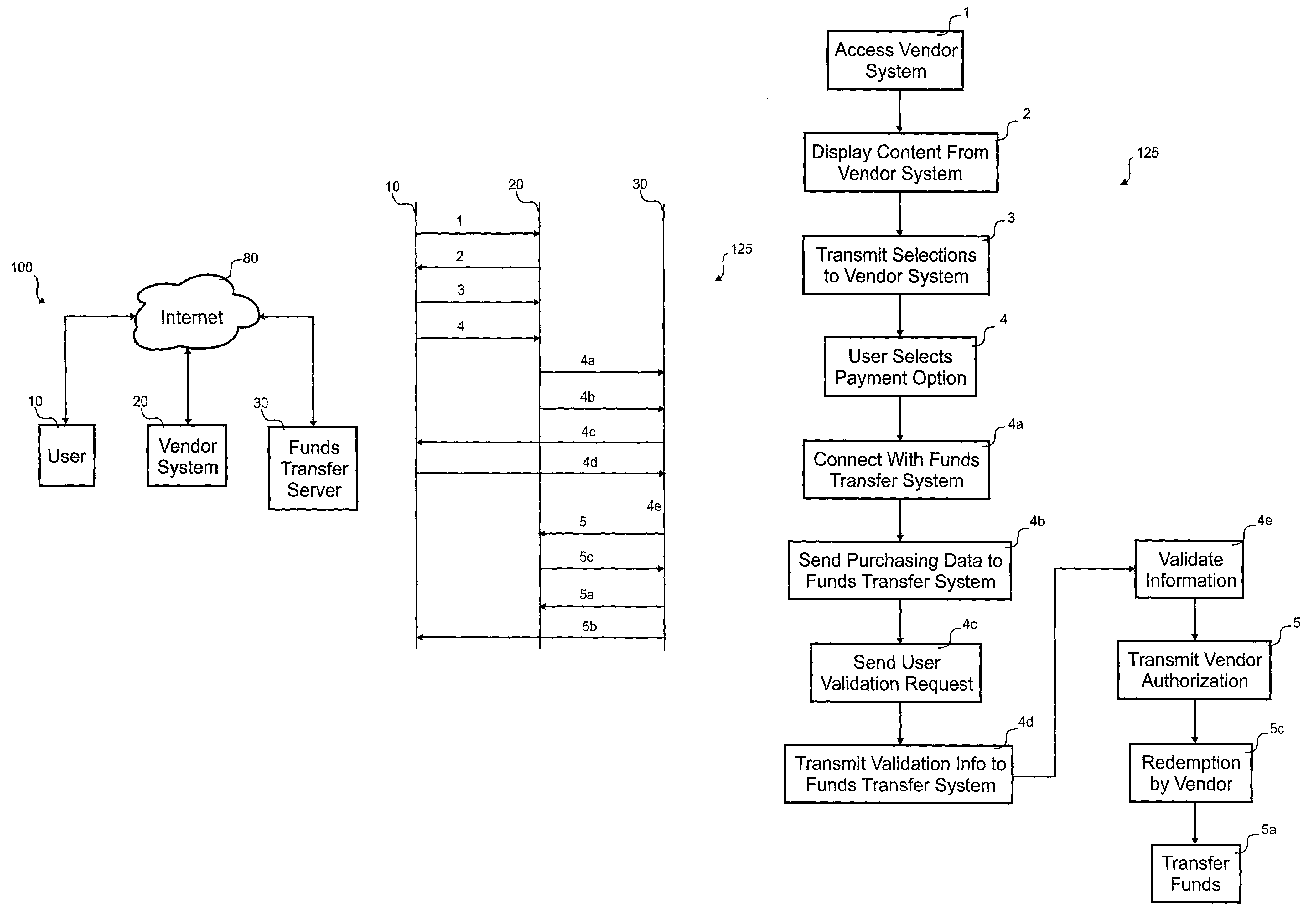

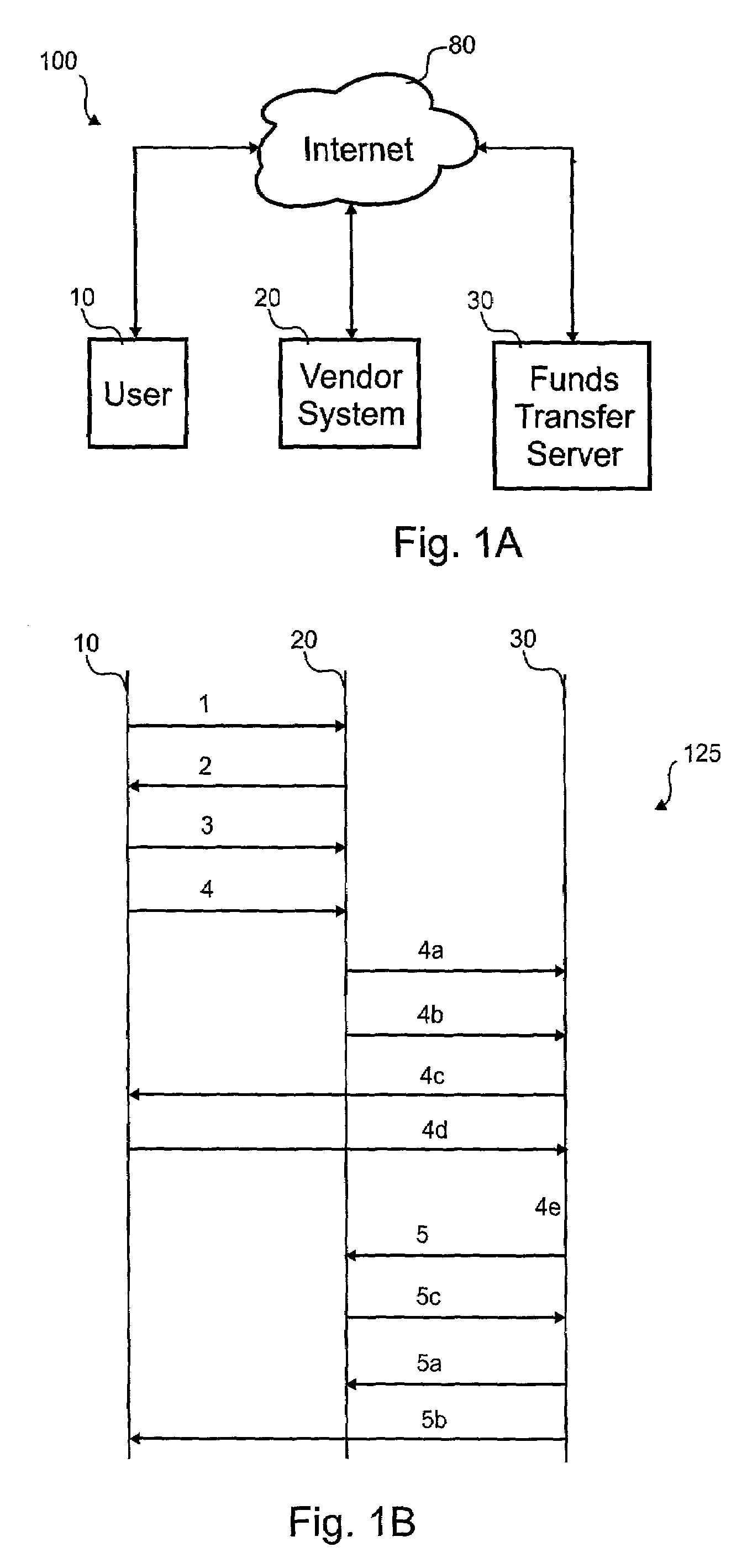

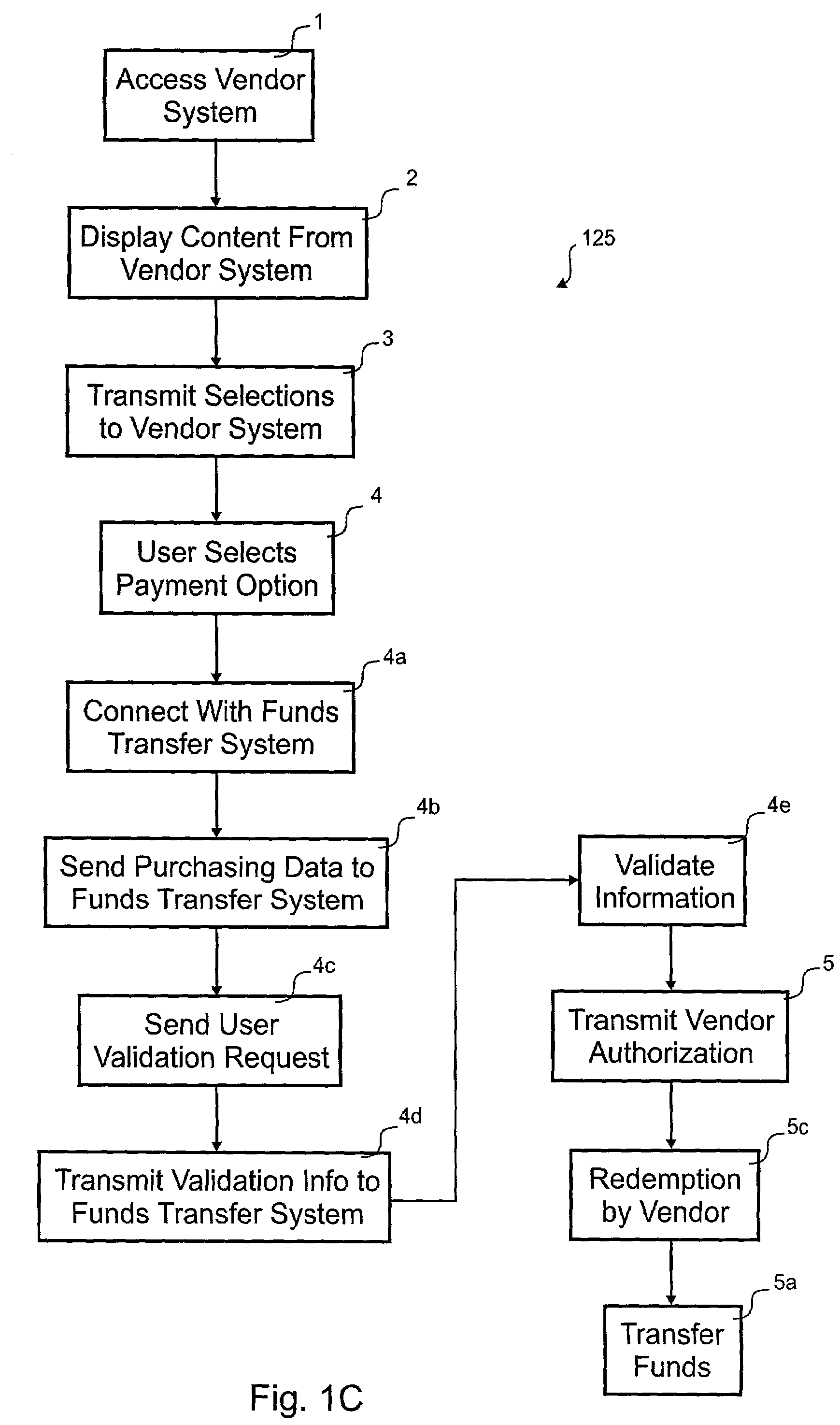

Method and system to accept and settle transaction payments for an unbanked consumer

A system and method is provided to accept and settle transaction payments for an unbanked consumer. A consumer initiates a transaction with a merchant, and the merchant may transmit transaction information to a central processing unit using an initiating processing unit. The central processing unit may generate a unique transaction identifier or the merchant may generate the unique transaction identifier which complies with the systems rules and notifies the central processing unit of the transaction information and unique transaction identifier. The system may provide the merchant and consumer the nearest payment processing unit. At the payment processing unit, the consumer presents the unique transaction identifier, which is transmitted to the central processing unit for validation. The consumer may also validate the transaction information. The consumer makes payment at the payment processing unit, and the payment information is transmitted to the central processing unit. The system may generate a confirmation receipt for the consumer, and the central processing unit notifies the merchant of payment by the consumer. The merchant may then fulfill the transaction. The system remits the payment to the merchant.

Owner:PAY CASH NOW

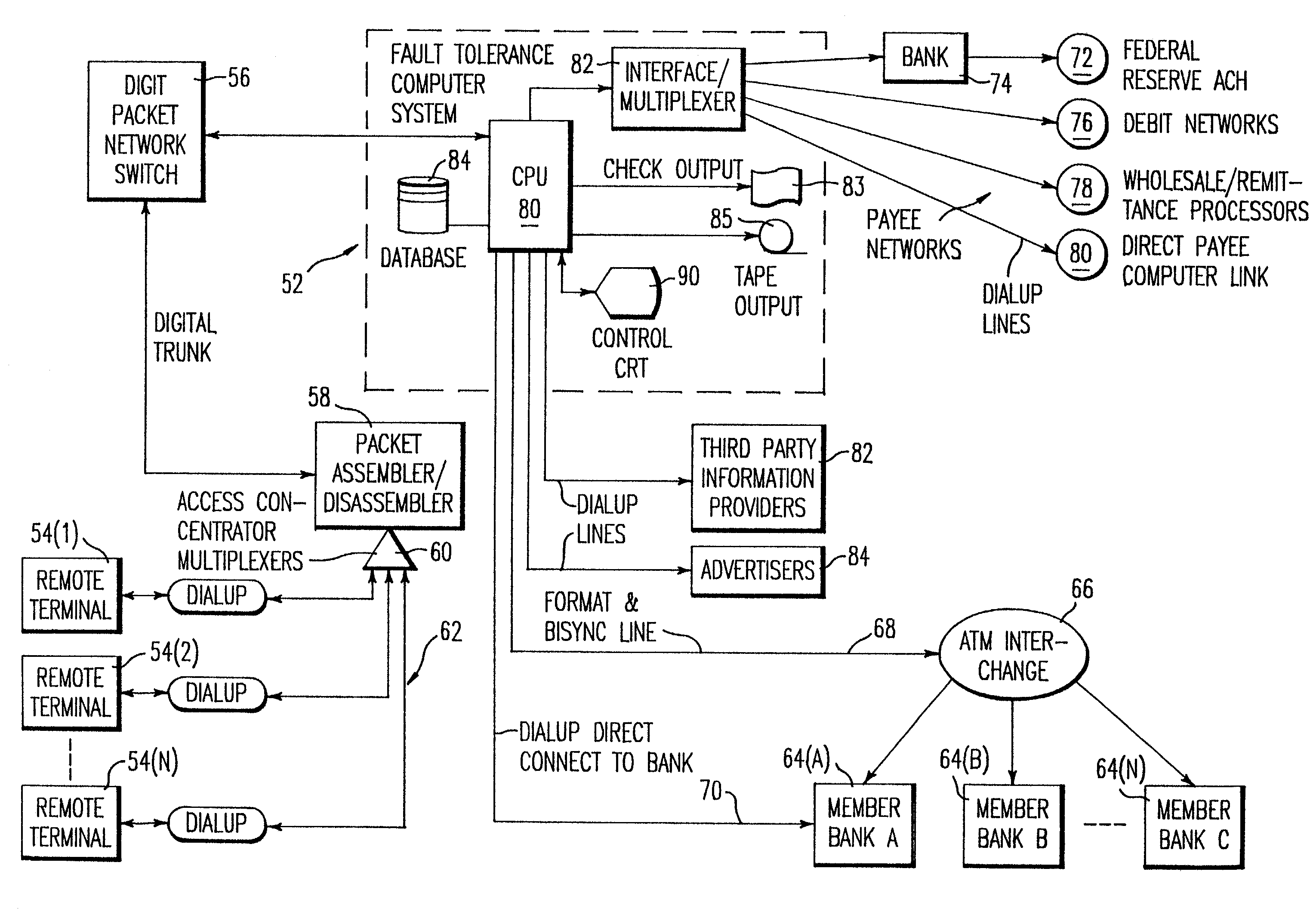

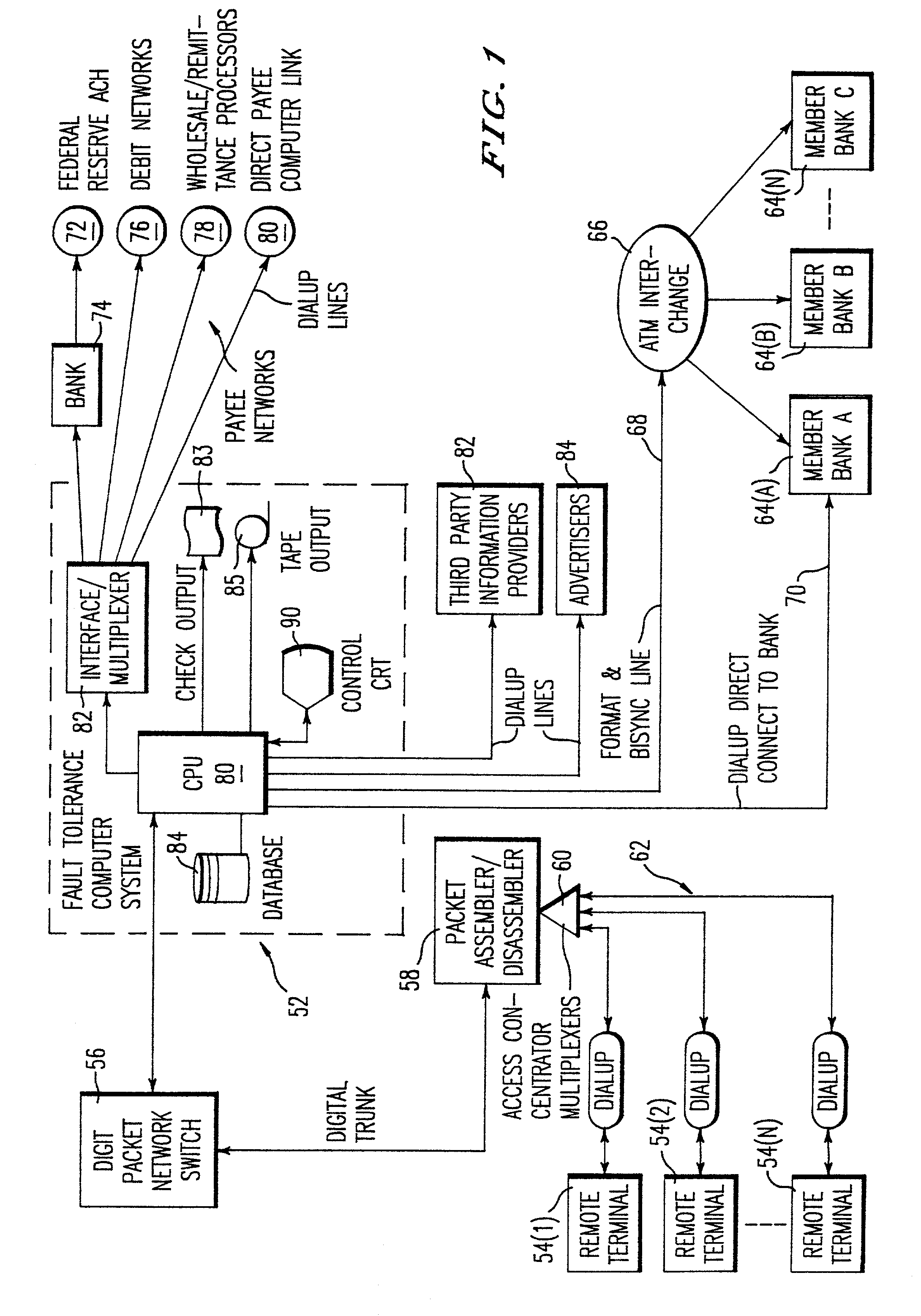

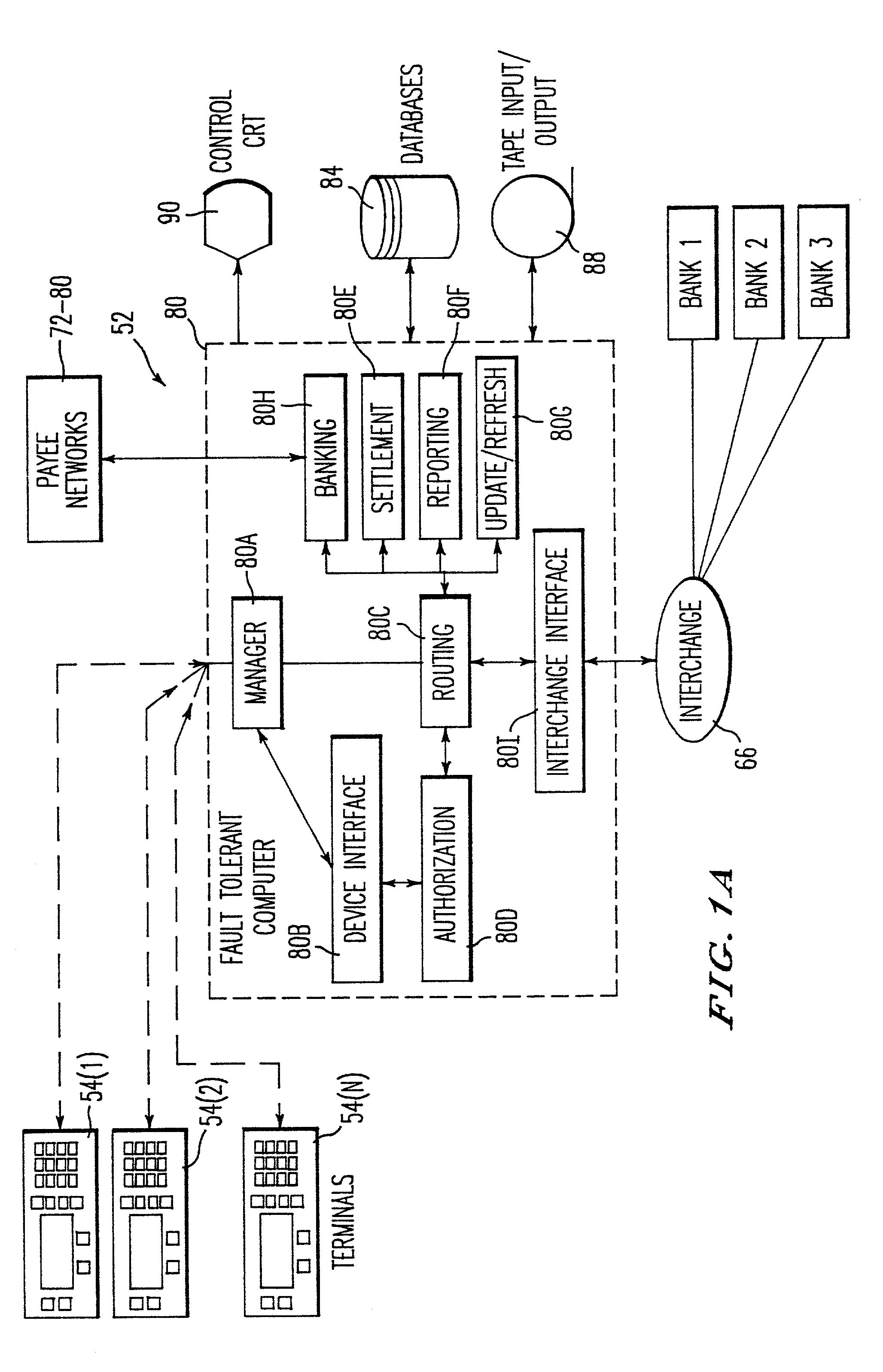

Method and system for remote delivery of retail banking services

A practical system and method for the remote distribution of financial services (e.g., home banking and bill-paying) involves distributing portable terminals to a user base. The terminals include a multi-line display, keys “pointing to” lines on the display, and additional keys. Contact is established between the terminals and a central computer operated by a service provider, preferably over a dial-up telephone line and a packet data network. Information exchange between the central computer and the terminal solicits information from the terminal user related to requested financial services (e.g., for billpaying, the user provides payee selection and amount and his bank account PIN number). The central computer then transmits a message over a conventional ATM network debiting the user's bank account in real time, and may pay the specified payees the specified amount electronically or in other ways as appropriate. Payments and transfers may be scheduled in advance or on a periodic basis. Because the central computer interacts with the user's bank as a standard POS or ATM network node, no significant software changes are required at the banks' computers. The terminal interface is extremely user-friendly and incorporates some features of standard ATM user interfaces so as to reduce new user anxiety.

Owner:OFFICIAL PAYMENTS

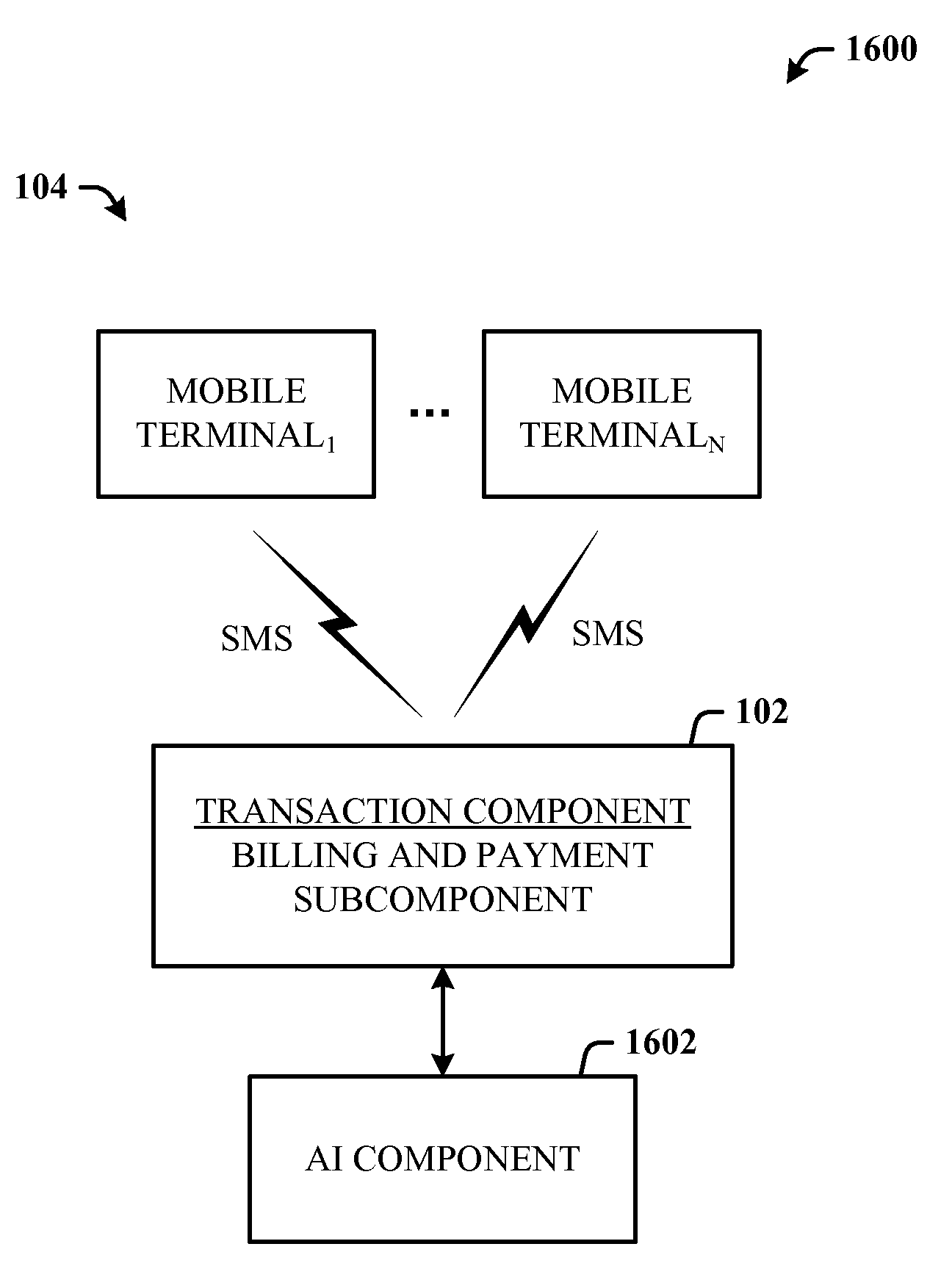

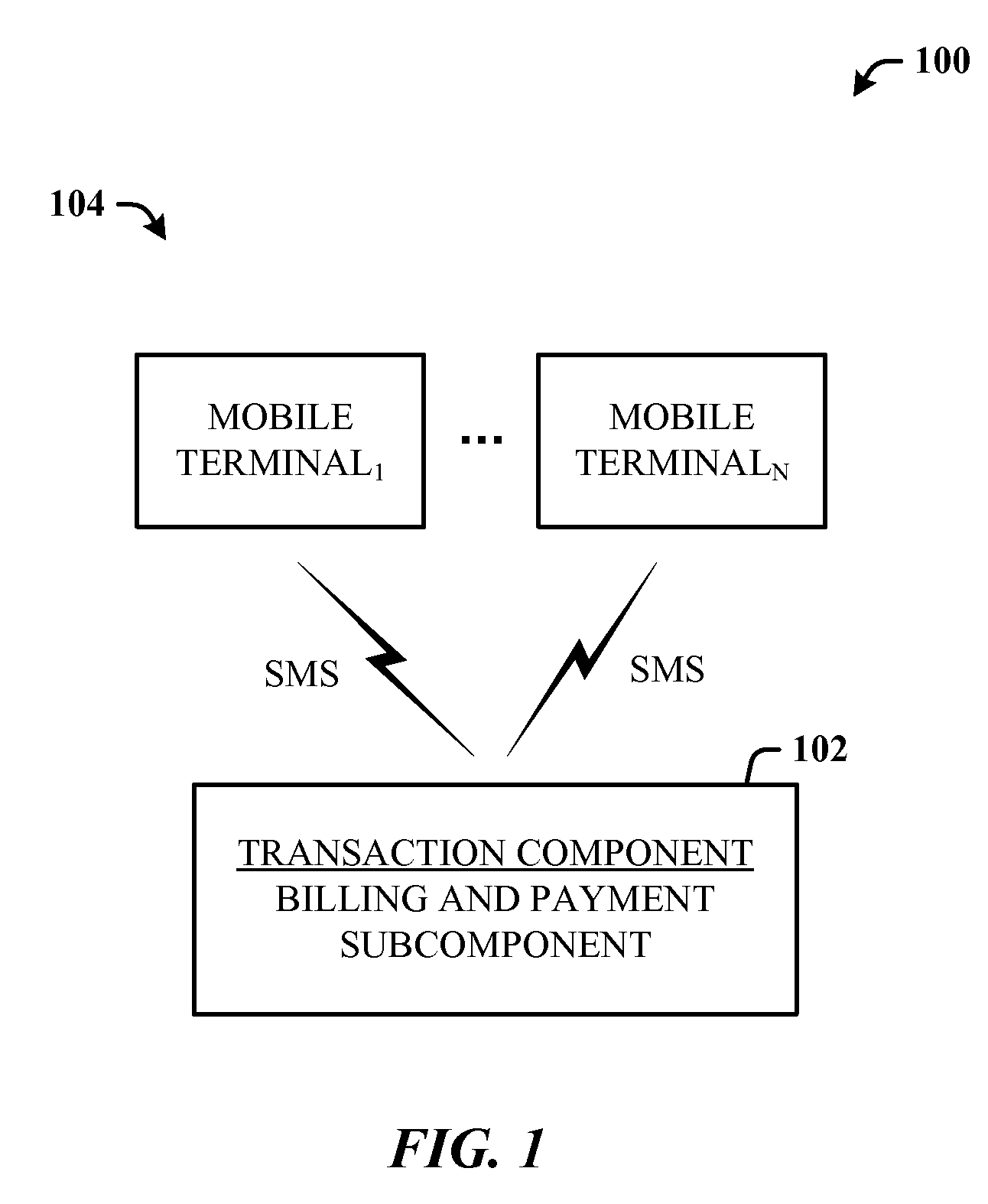

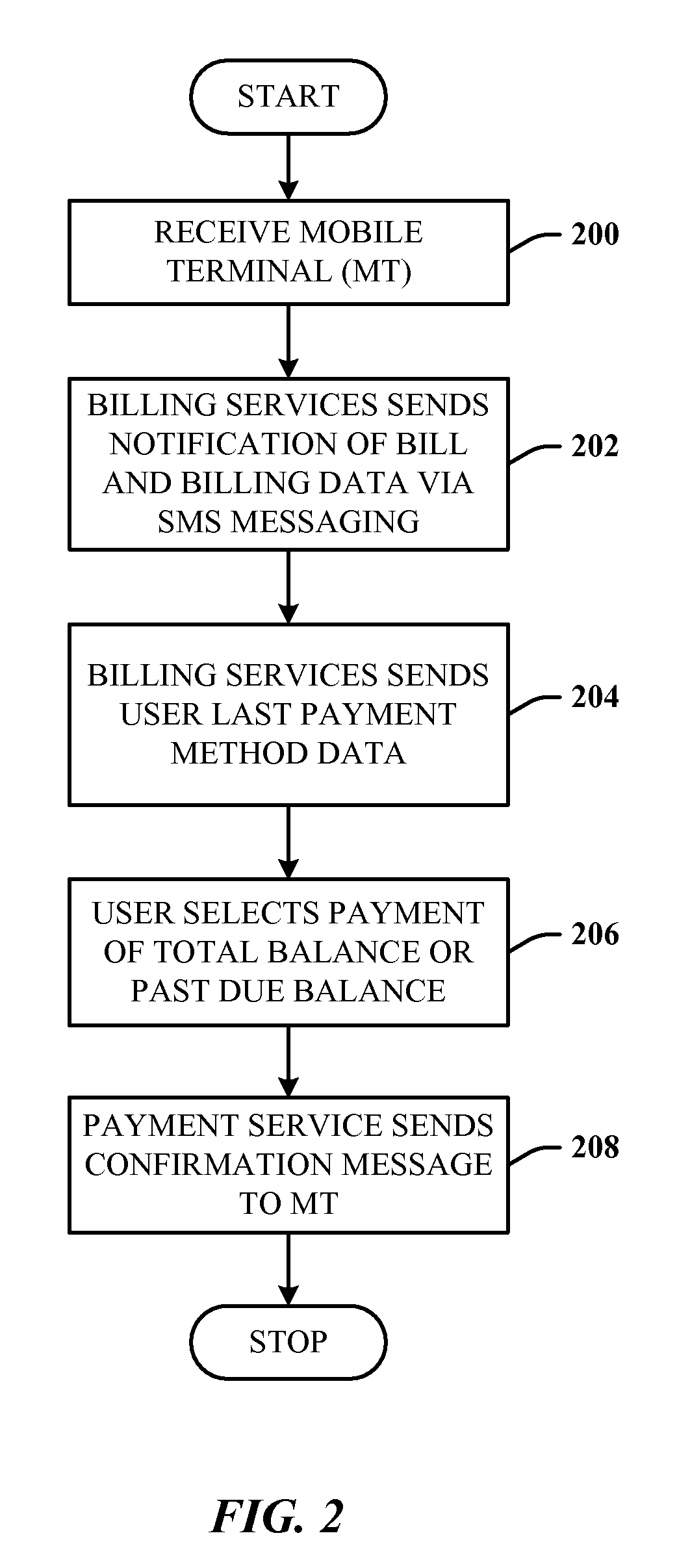

Mobile communications billing architecture

InactiveUS7945240B1Low costEasy accessPayment architectureSubstation equipmentCredit cardBank account

A telecommunications payment system which includes a transaction component that facilitates the communication of at least billing and payment information to at least one of a plurality of mobile terminals. In operation the carrier will cause the transaction component to communicate an SMS message to the mobile terminal that includes a billing notification message. The notification message can include a current account balance, including total and past due, if applicable, the user's last payment method, and personal financial account data such as the last four digits of a credit card and / or bank account file. When providing the proper reply, payment processing is initiated such that an amount of funds will be transferred from the user's financial institution to the carrier back-office systems or its financial institution.

Owner:CINGULAR WIRELESS II LLC

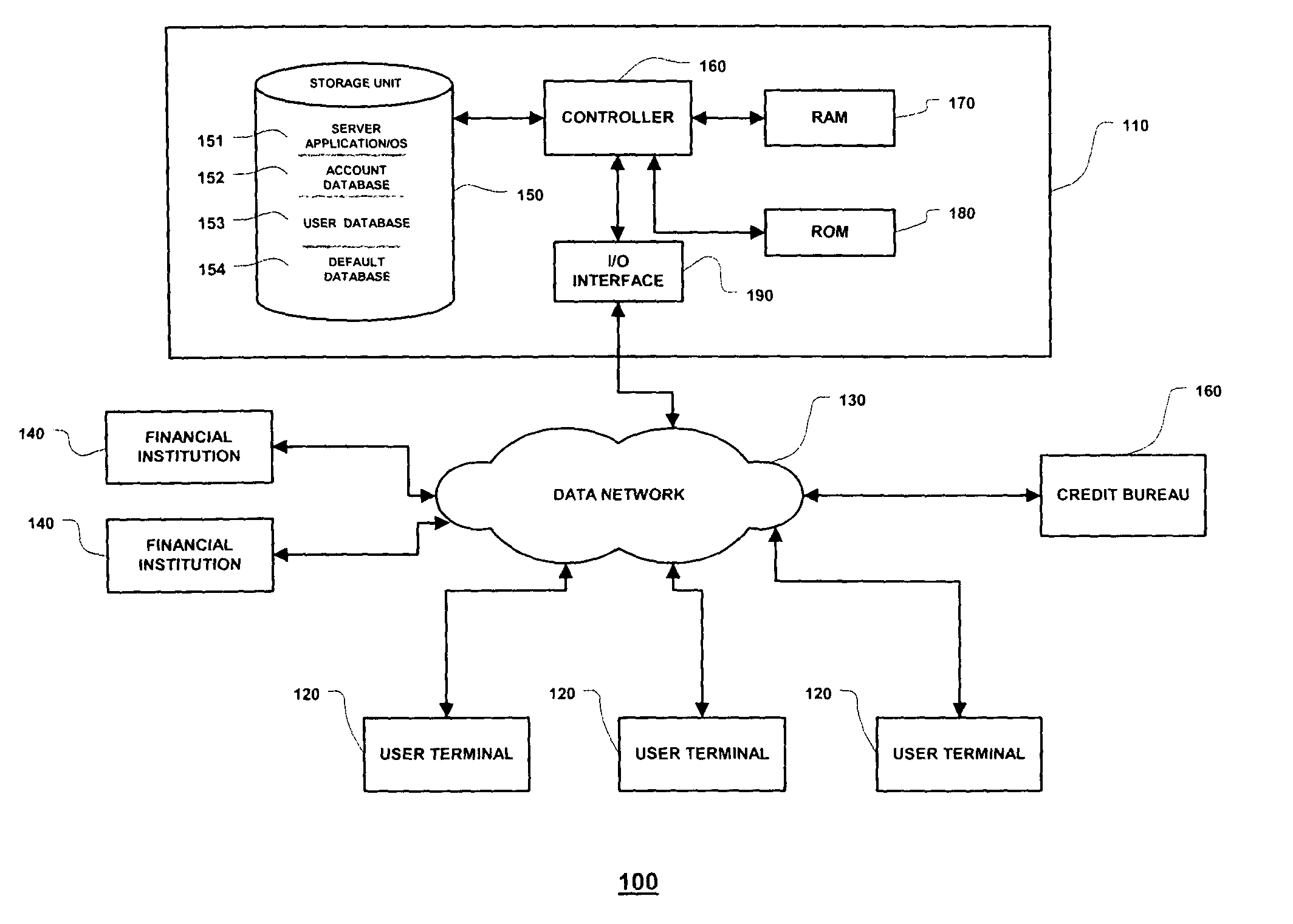

Method and system for underwriting and servicing financial accounts

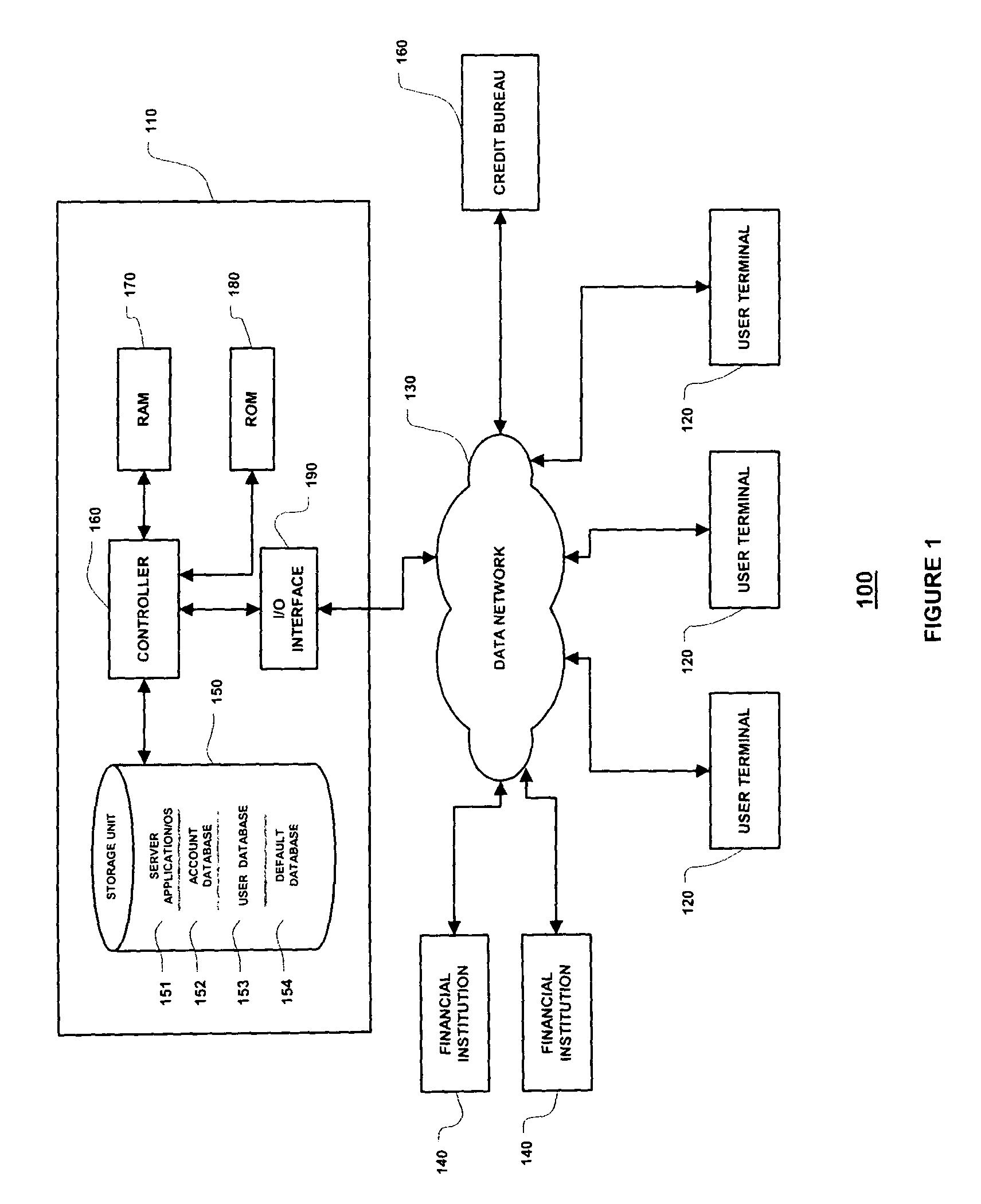

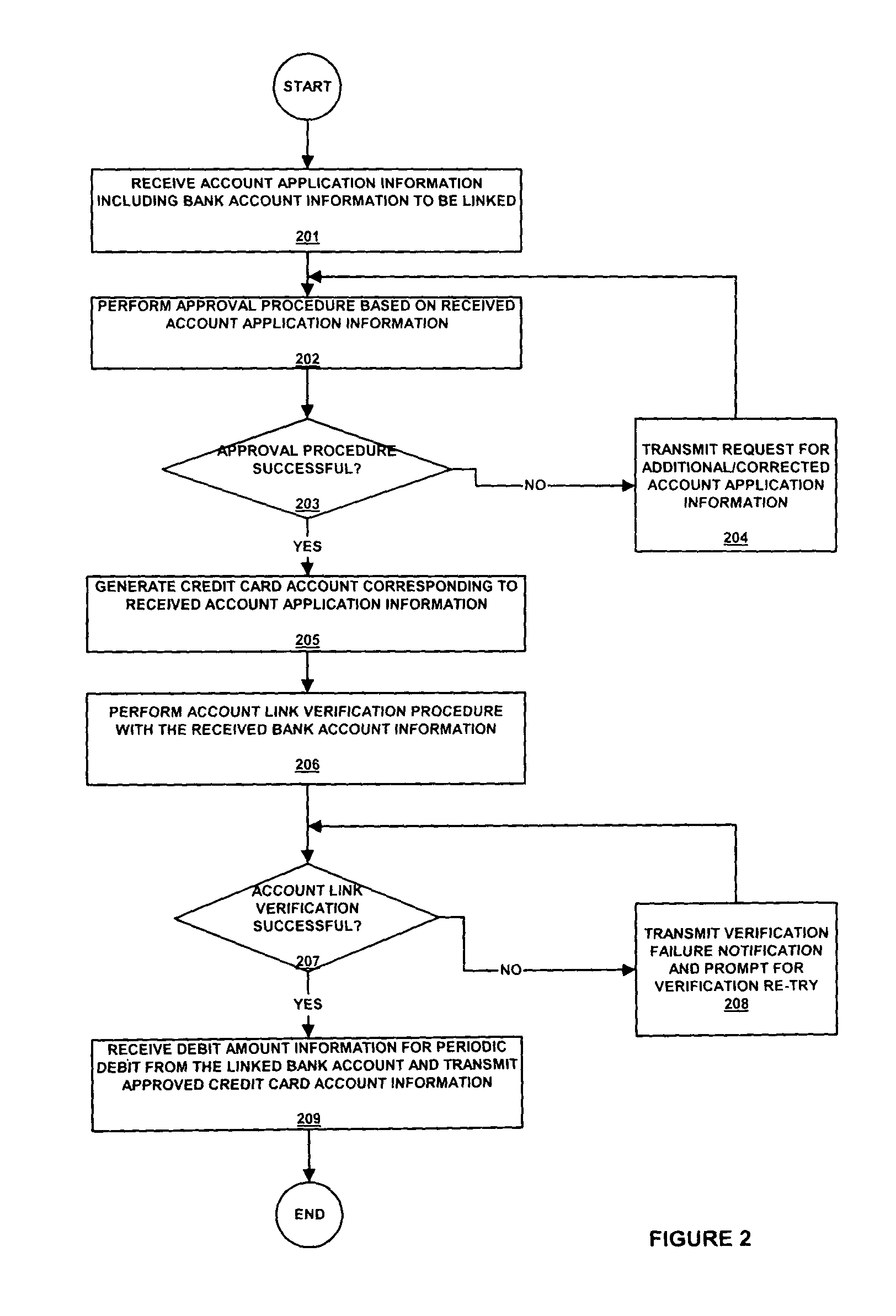

Method and system for providing financial account underwriting and servicing exclusively using online transactions by requiring a link to the account holder's bank account as a condition of account approval process and account servicing performed exclusively online with the account holders including the steps of receiving account application information including a bank account information, depositing at least one deposit amount to the bank account corresponding to the received bank account information, receiving a deposit verification amount, from the applicant, confirming the deposit verification amount received from the applicant, and generating a financial account corresponding to the received account application information, where the financial account is electronically linked to the bank account for periodic debit transaction to withdraw funds from the linked bank account and to deposit the withdrawn funds into the linked financial account, and a server terminal configured to perform these steps are provided.

Owner:HATTERSLEY MICHAEL +2

Method and apparatus for use of a temporary financial transaction number or code

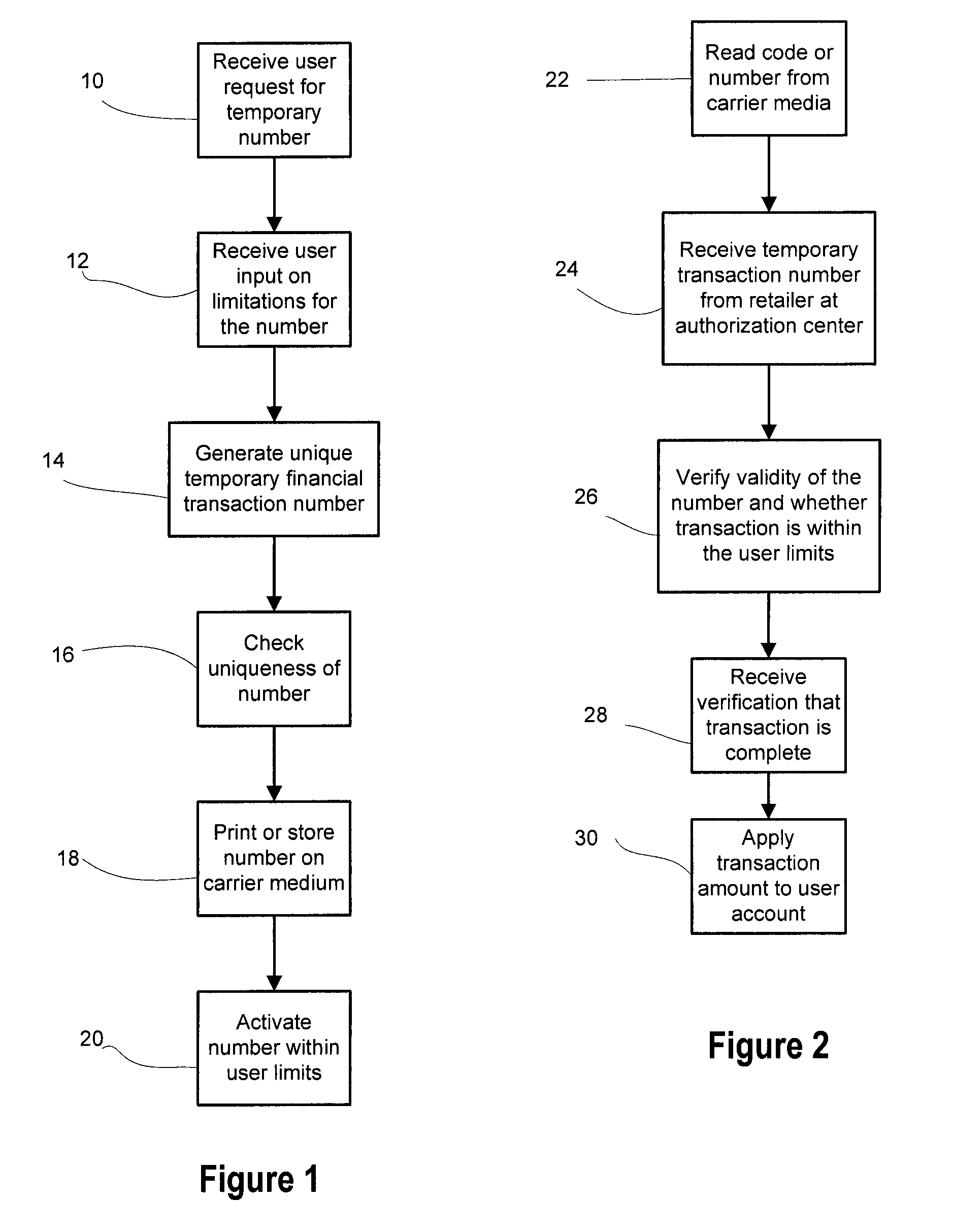

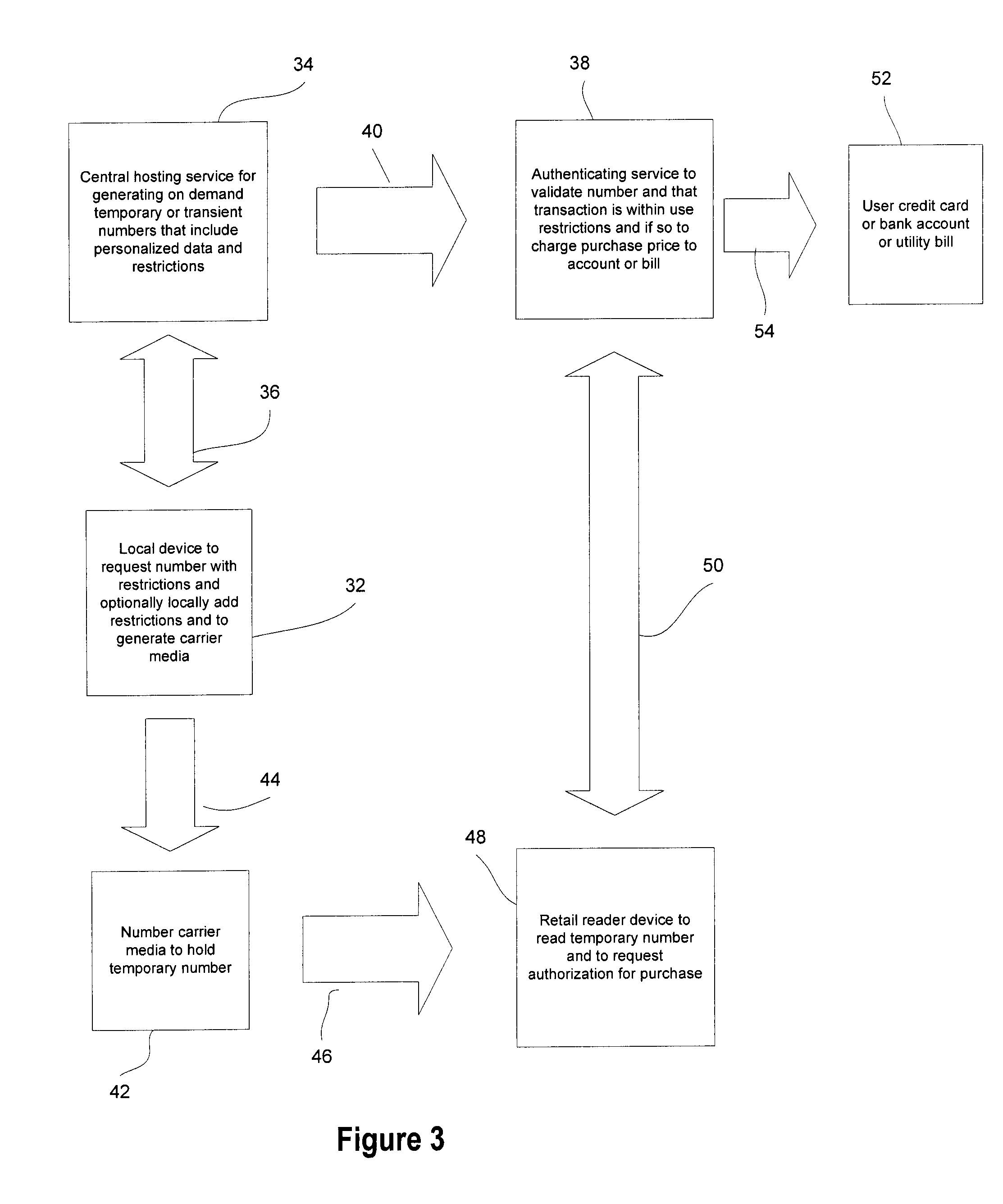

A temporary financial transaction number is generated for conducting a financial transaction, such as for paying for goods or services. The temporary number has limits on use, such as time, and amount limits and limits on the type of goods or services that may be purchased or on the type of business at which the purchase may be made. The limits may be encoded into the temporary number or otherwise linked to the number. User identification information, or information on other authorized users, may also be encoded into the number or otherwise linked to the number. When presented for a payment, the number is checked for validity as well as whether the purchase is within the limits. An authorized purchase is applied against a user bank account or credit card account without disclosure of the account information. The temporary number is printed or is displayed on a display of a portable electronic device for presentation to the seller, or is transmitted to the seller for on-line purchases.

Owner:IPDEV

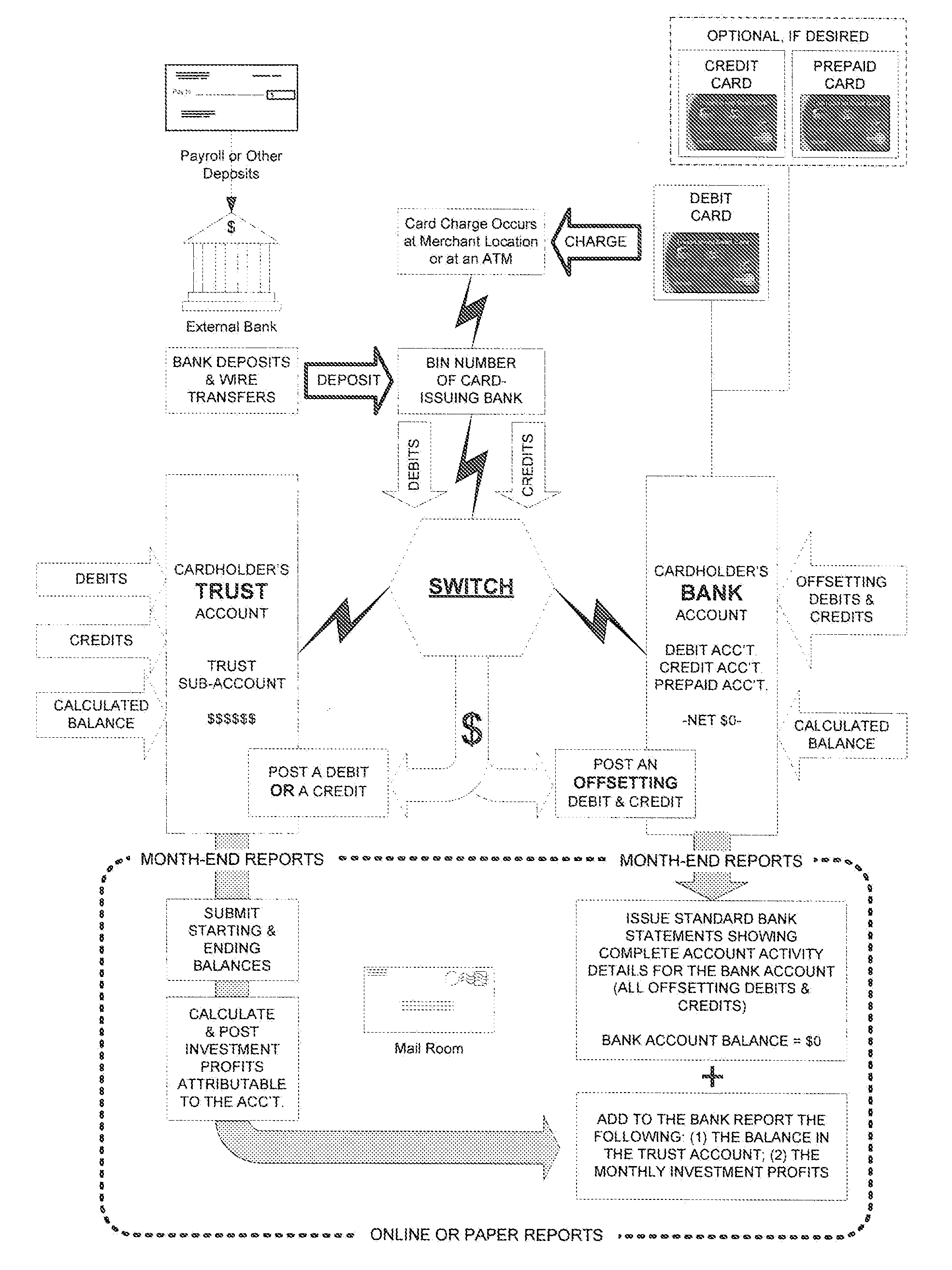

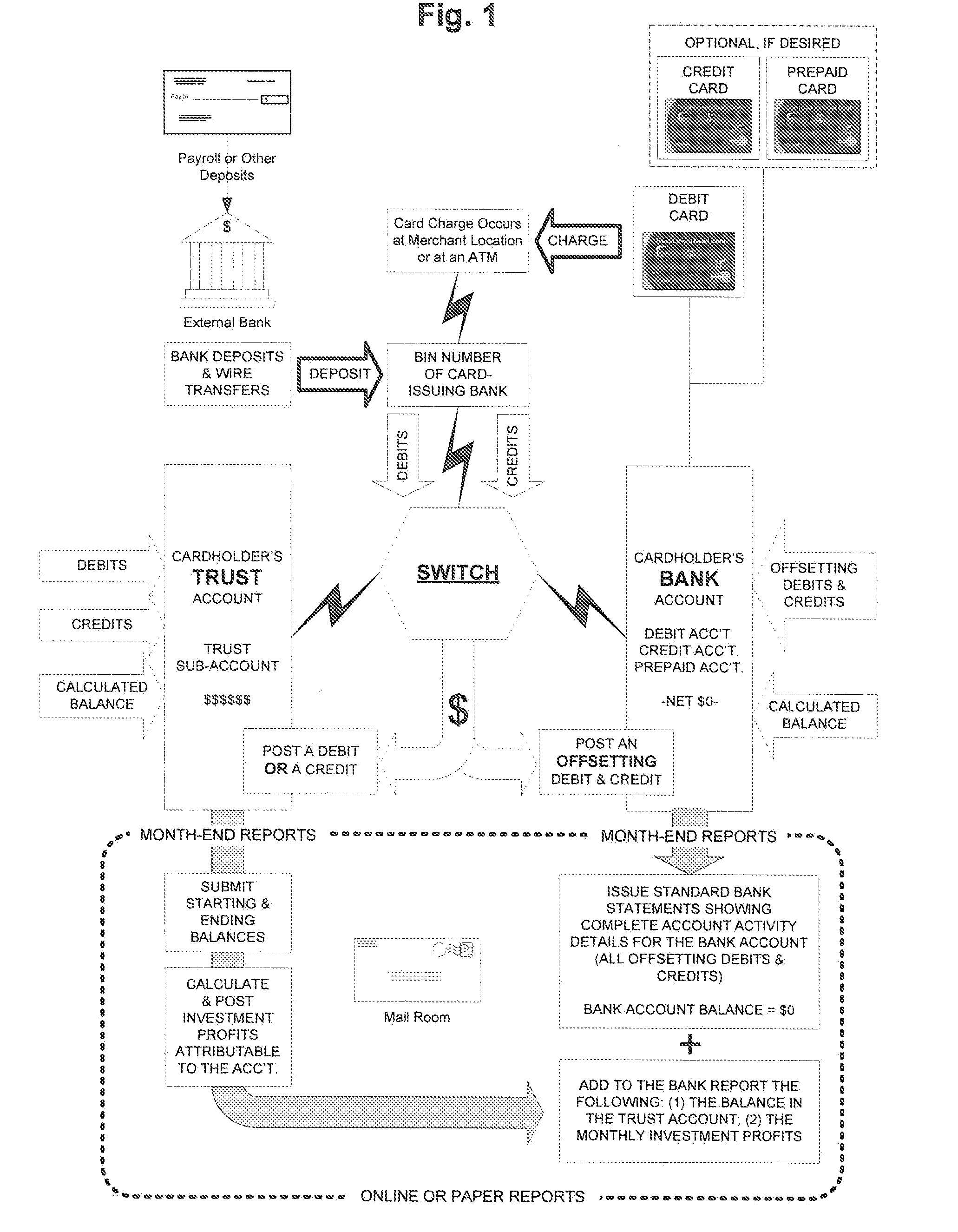

Revenue-producing bank card system & method providing the functionality & protection of trust-connected banking

A revenue-producing, charge card system also manages account balances to create an investment profit for the card holder. A trust account has a trust-account balance reflecting a first amount of funds, is constructed to subsequently record debits and credits related to the balance, and is constructed for access via remote communication. A bank account has a bank-account balance reflecting an initial zero balance, is constructed to further record debits and credits related to the balance, and is constructed for access via remote communication. A debit card is constructed for communication with the trust account and the bank account, and a switch is in communication with the trust account and bank account. The trust account and the bank account are constructed for intercommunication via the switch so that a card user can pass debits and credits to the trust account through the bank account so that the funds of the trust account can be managed via the trust account. There are also methods of producing revenue thorough a charge card, a revenue-producing machine for users who have bank accounts, and a revenue-producing, debit-card system for a user who has a bank account that is connected to a trust-like structure combined with a debit card connected to the trust-like structure. In addition, there is a controller, for a networked trust account and a networked bank account that are capable of communicating via a network, that maximizes revenue to the holder of both accounts, and a corresponding method. In addition, there is a principal-protected, revenue-producing investment system, an international financial system, and a method of providing an alternative international fiduciary financial system.

Owner:DE LA MOTTE ALAN L

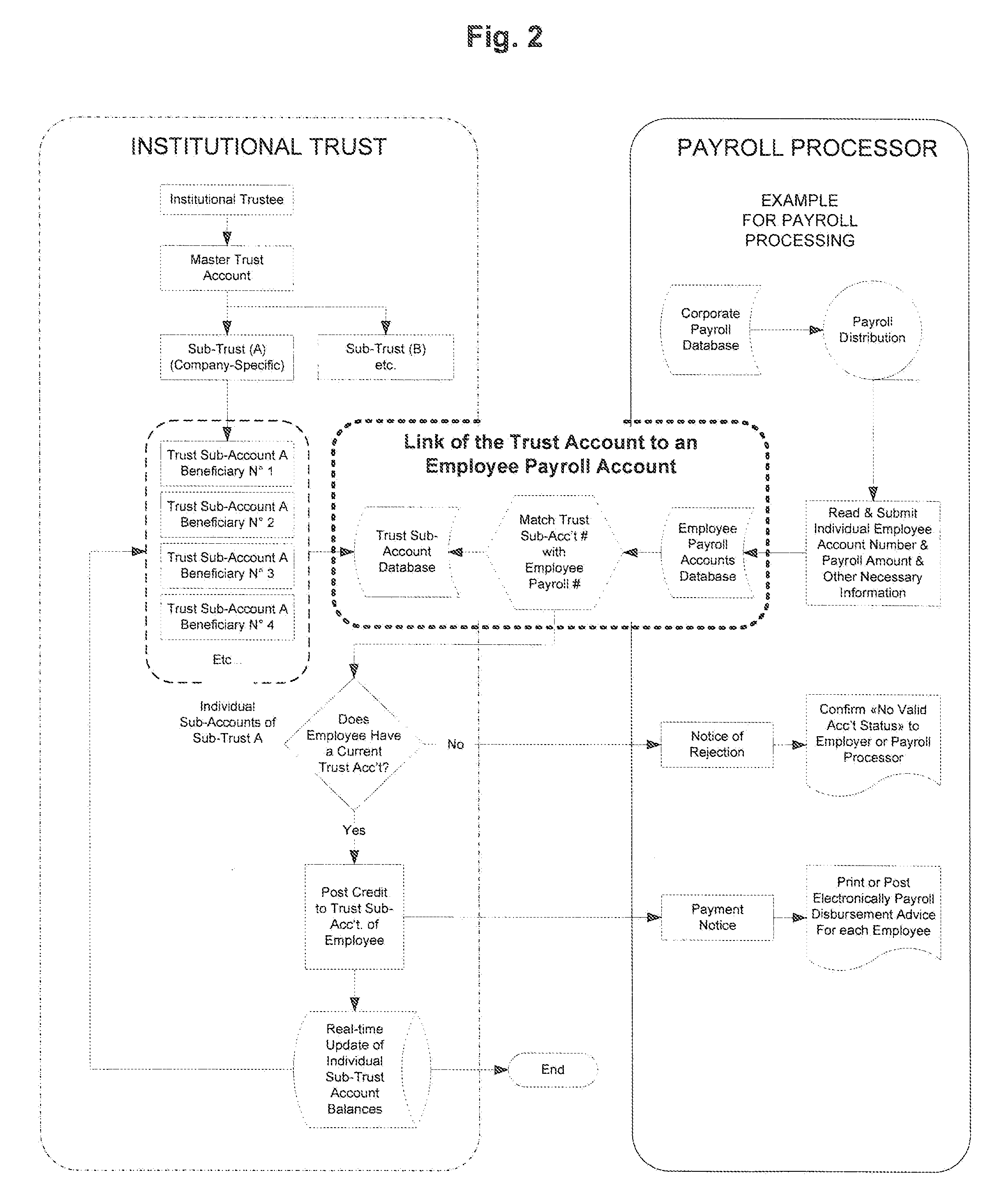

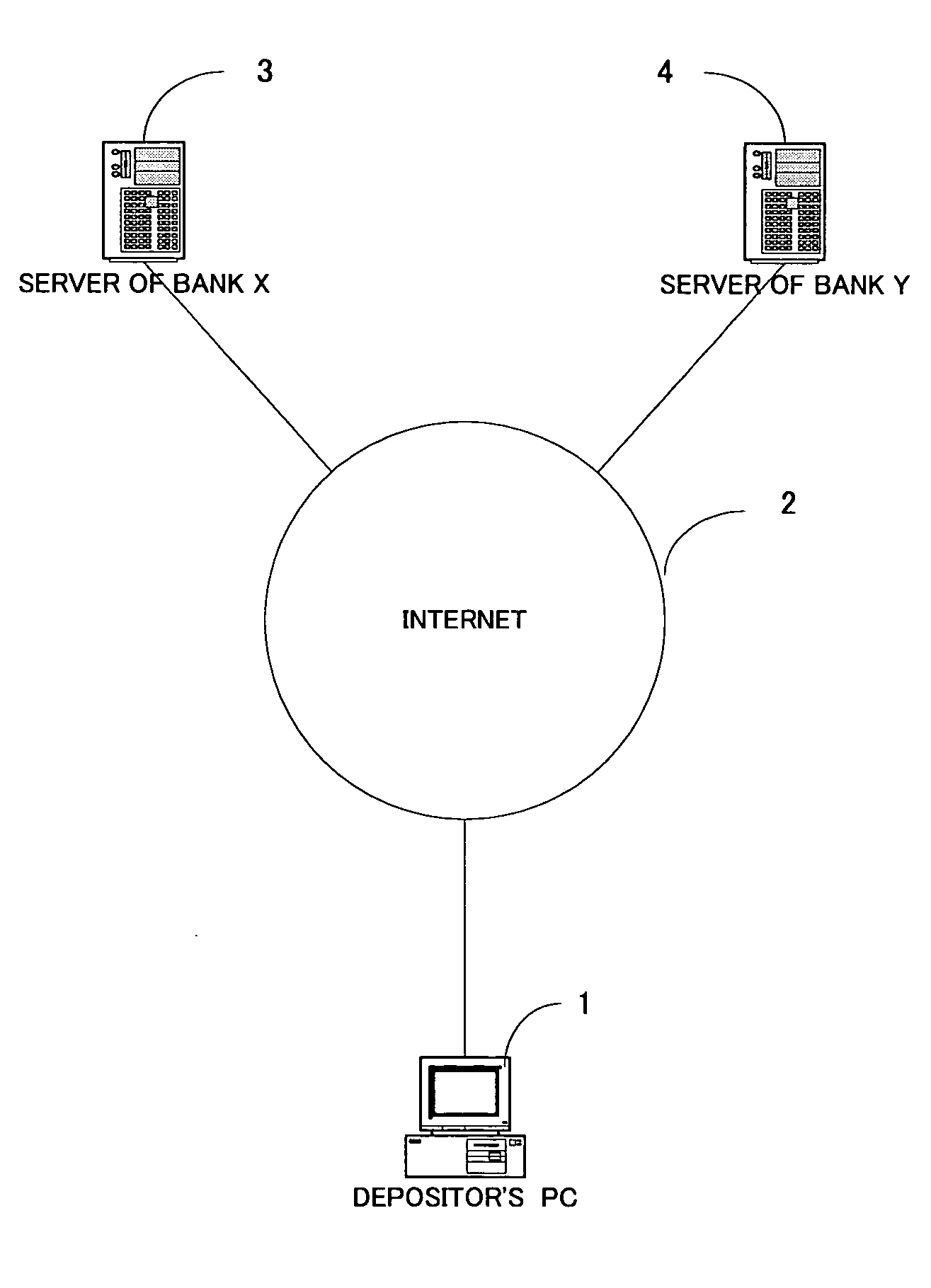

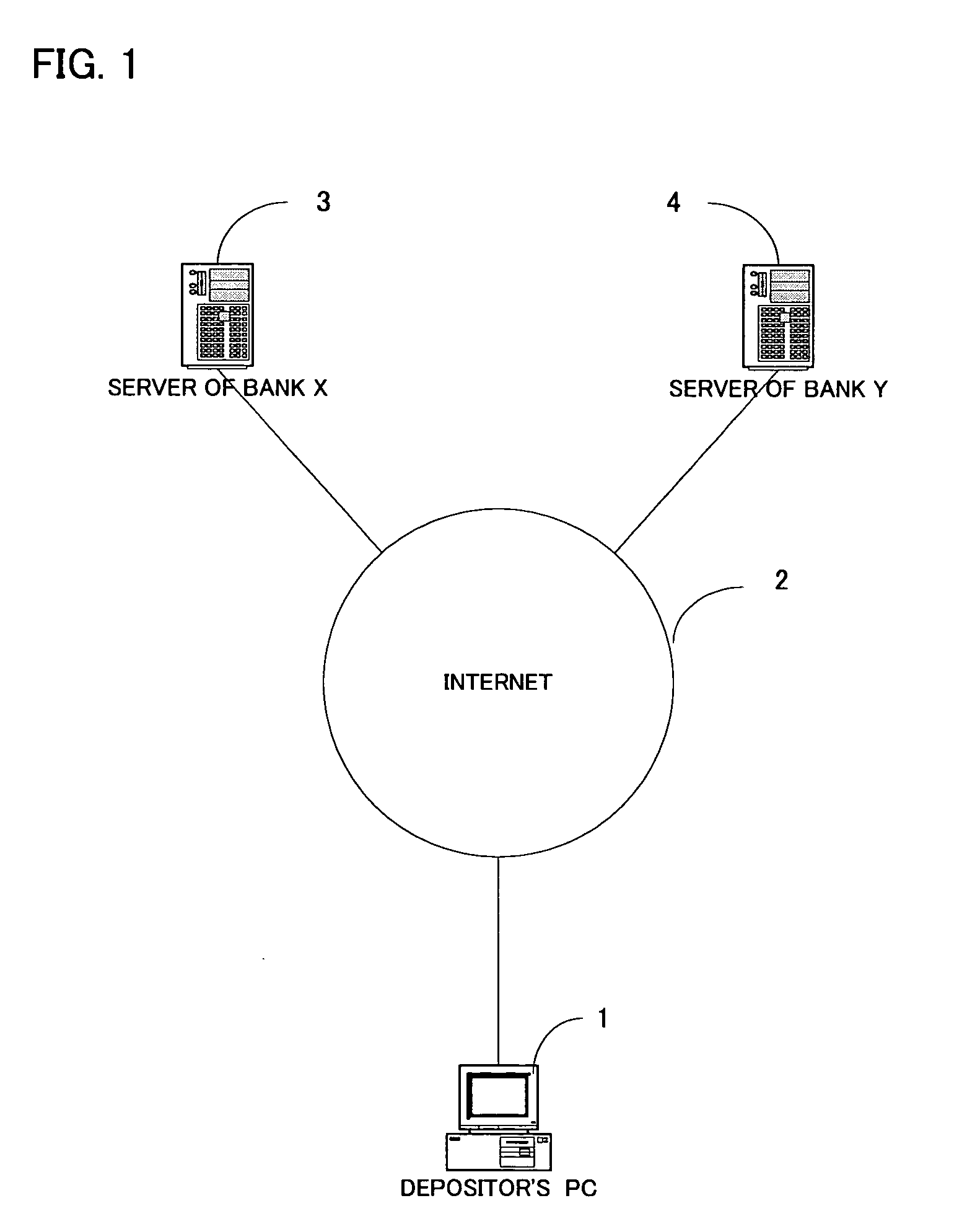

Small amount paying/receiving system

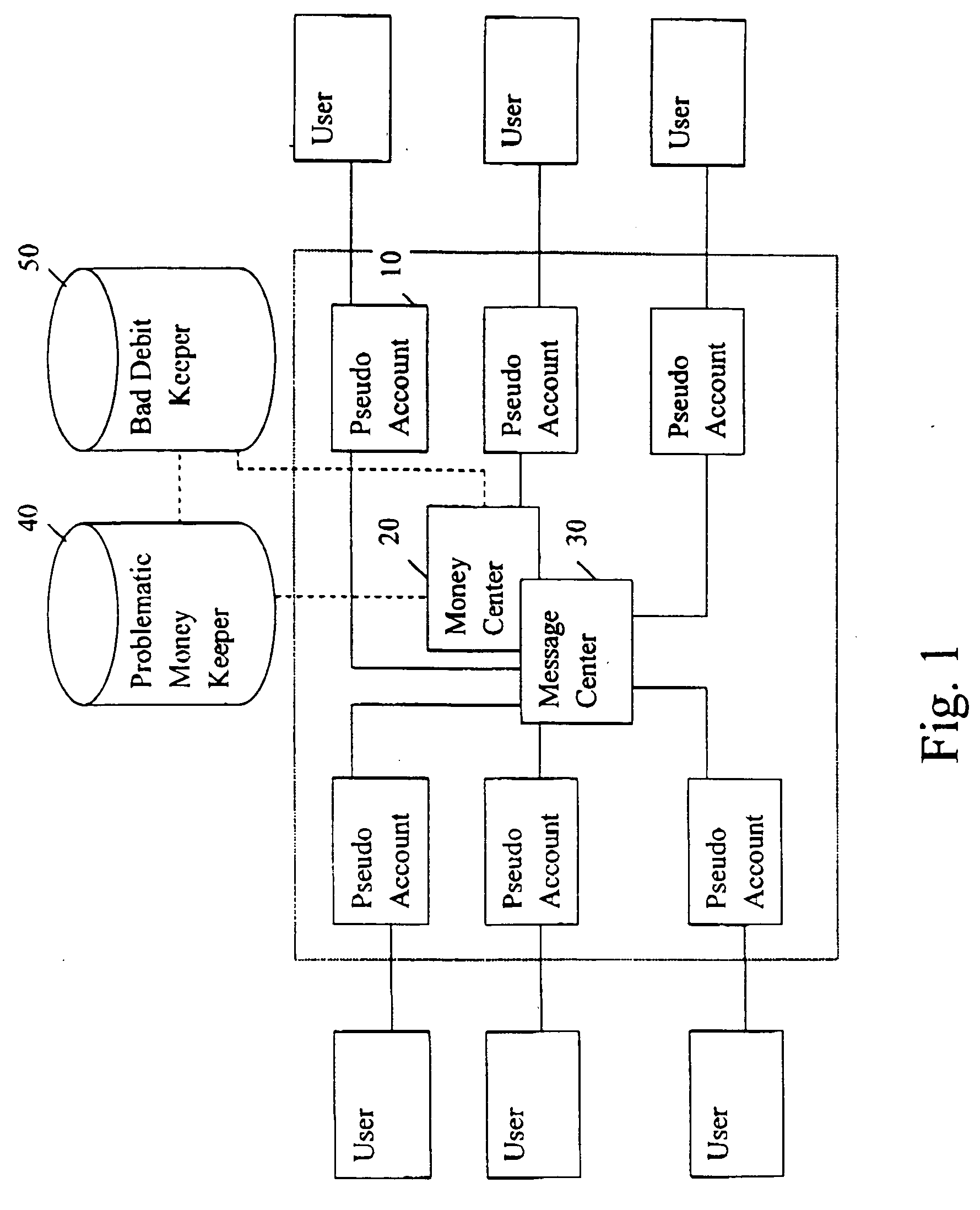

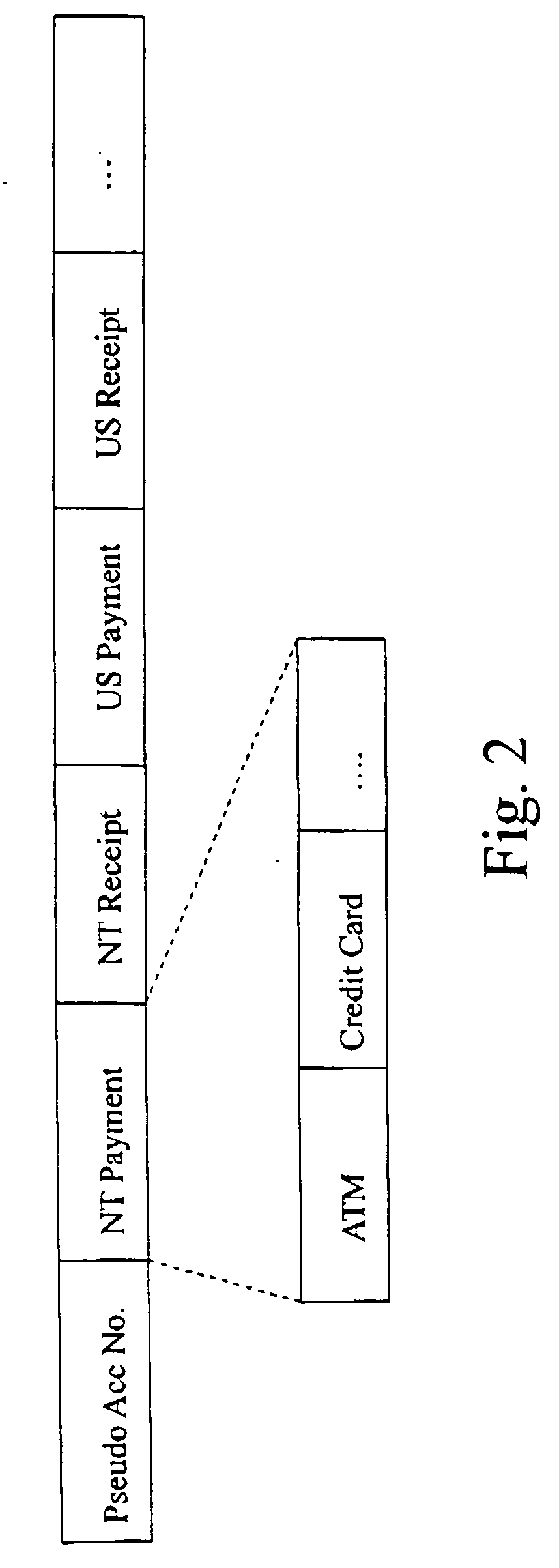

Disclosed is a small amount paying / receiving system for network trading comprises a plurality of pseudo accounts for users to use, each account including a receiving frame and a paying frame for respectively recording the data of the user's depositing, receiving and paying; a money center providing a substantial account corresponding to the respective pseudo accounts to deposit the money for the users; and a message center connecting with the money center. When receiving the message indicating that a first user want to make a trade with a second user and pay for the trade, the message center deducts the amount of the payment from the first user's pseudo account in no time, notifies the second user to provide commodity or service in real time, records the incoming of the payment on the second user's pseudo account after receiving the message indicating the receipt of the trading object from the first user, and notifies the money center to transfer the money from the substantial account to the second user's predetermined bank account after a predetermined period of time.

Owner:LEE FUNG CHI

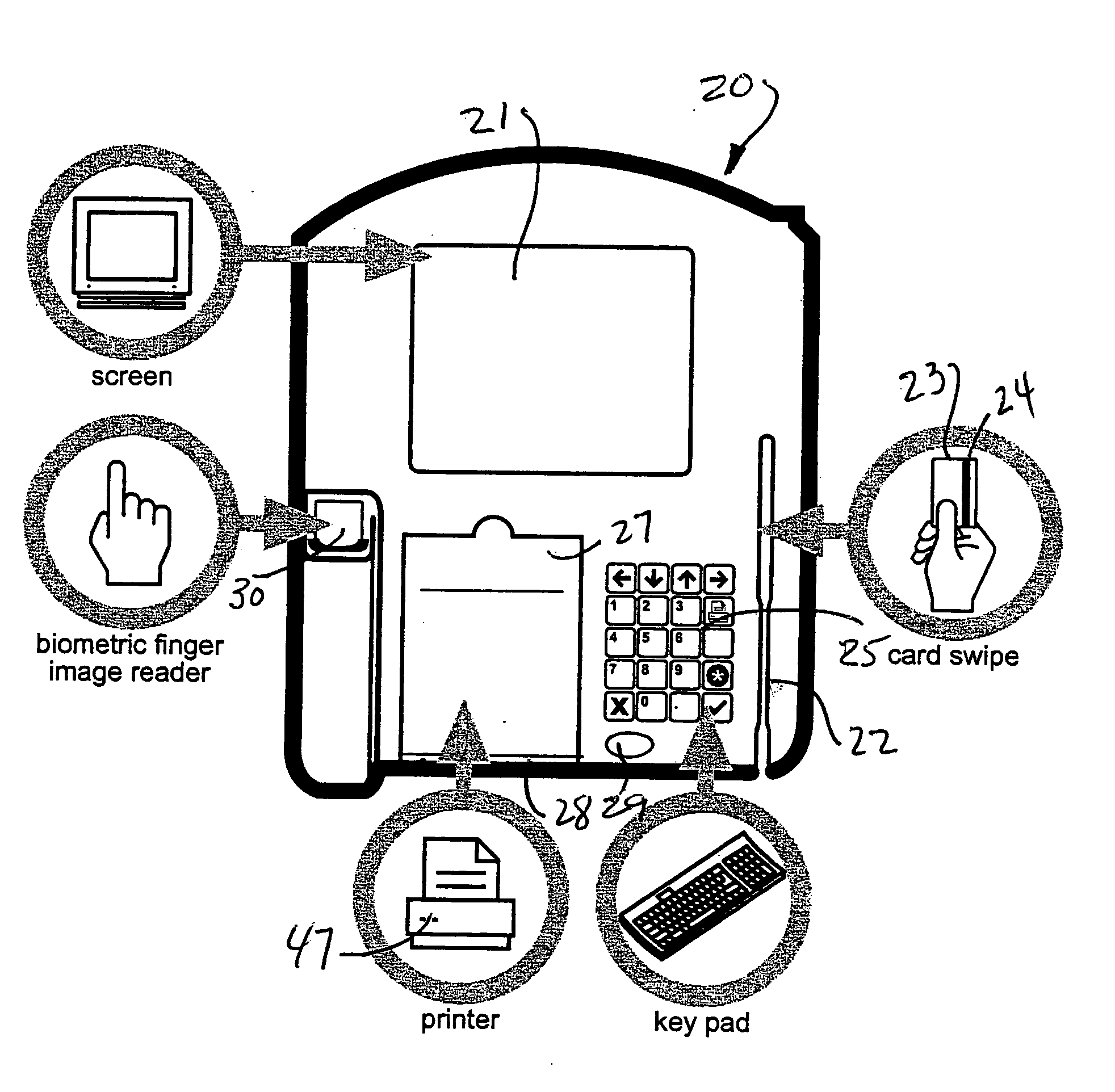

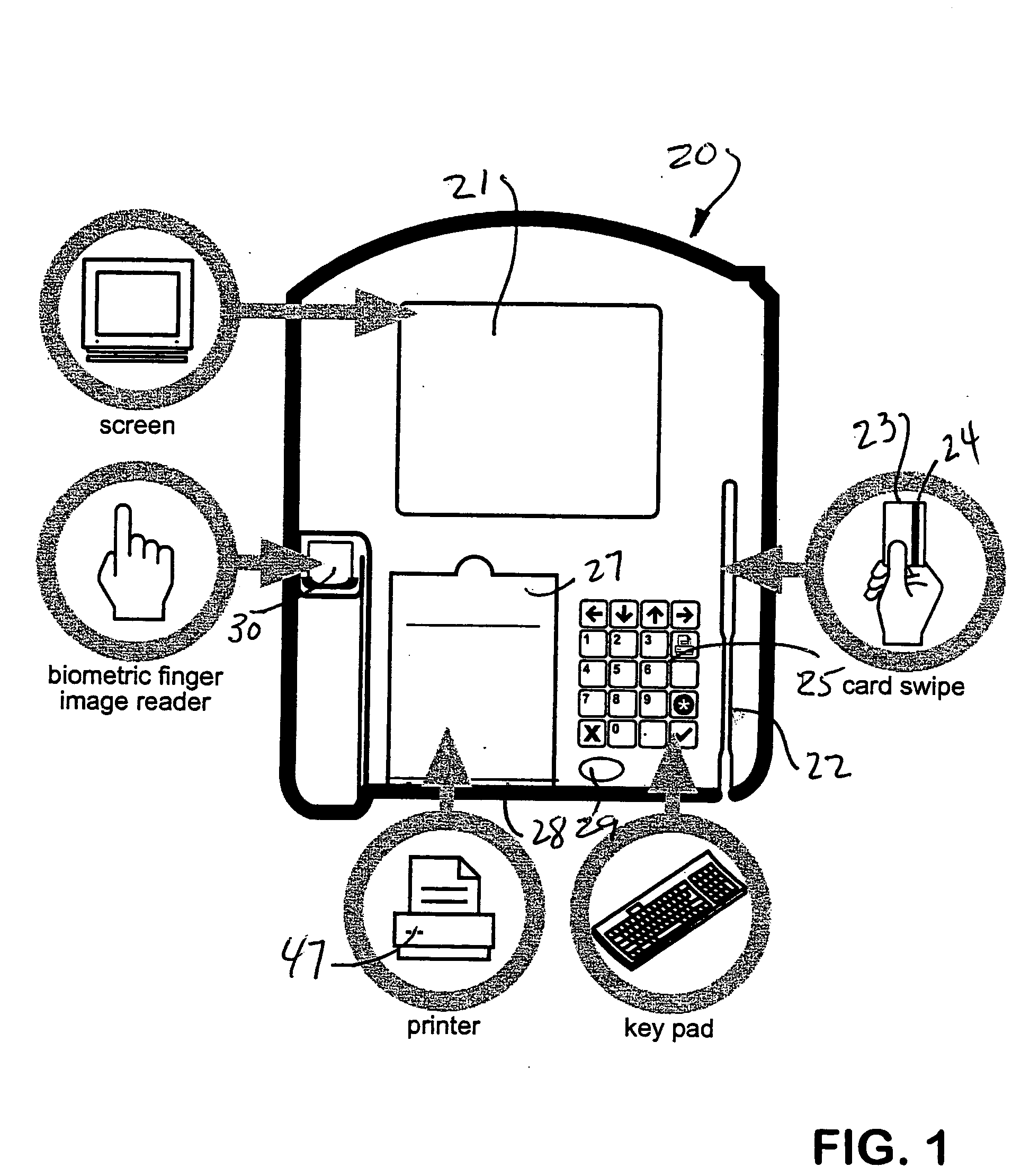

Biometric multi-purpose terminal, payroll and work management system and related methods

InactiveUS20050109836A1Efficient use ofAssist in managementRegistering/indicating time of eventsFinancePersonal identification numberBank account

Employees gain access to a payroll and work management system by authentication at a multi-purpose terminal with a bankcard encoded with a unique account number and a personal identification number (PIN). The terminal may then be used to check-in and checkout of work, to receive new work instructions or assignments, to review payroll details, to print a payroll stub, to execute financial transactions, to print a receipt of financial transactions or to review or to upload the results of work quality audits. The invention also includes systems and methods that utilize such multi-purpose terminals to calculate the payroll and deductions for each employee and to issue electronic fund transfers from the employer's bank account to deposit the net pay in a bank account associated with each employee's bankcard so that the pay is immediately accessible by each employee, such as by withdrawal of cash at an ATM or by purchases at a point of sale. Electronic payrolls may be processed and employee's accounts credited with pay on a daily basis, or on any preset period of time, including hourly.

Owner:AMERICAN EPS

Online incremental payment method

According to the invention, a process for transferring funds between a payor and a payee in an online transaction is disclosed. In one step, information is received from the payor for debiting a bank account associated with the payor. Authorization is transmitted to the payee to request debits from the payor. The total of all debit requests does not exceed an amount that is authorized. A first request is received from the payee to debit the customer a first portion of the amount. A first debit is initiated from the bank account for the first portion of the amount. A second request is received from the payee to debit the payor a second portion of the amount. A second debit is initiated from the bank account for the second portion of the amount.

Owner:THE WESTERN UNION CO +1

Method of making money payments

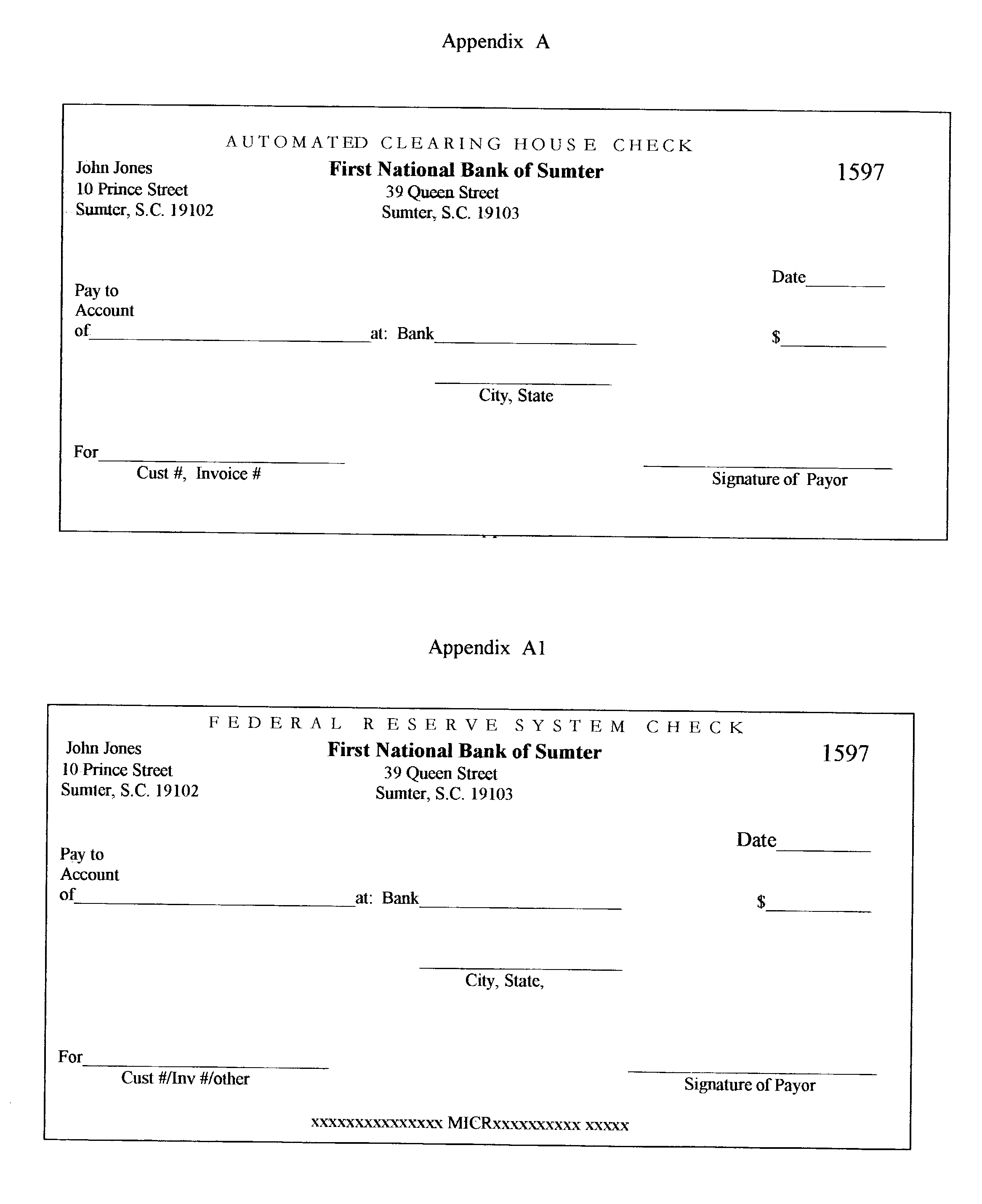

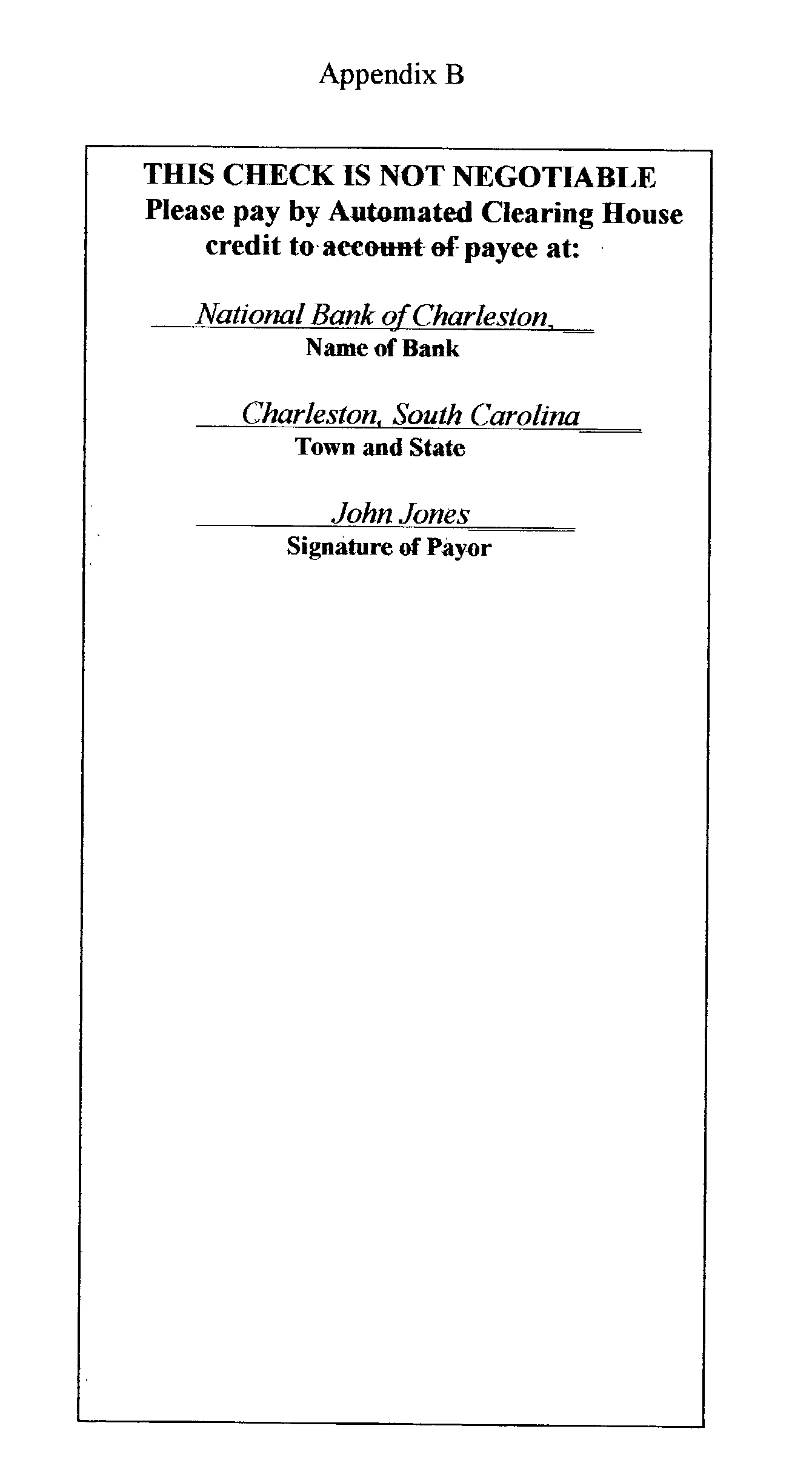

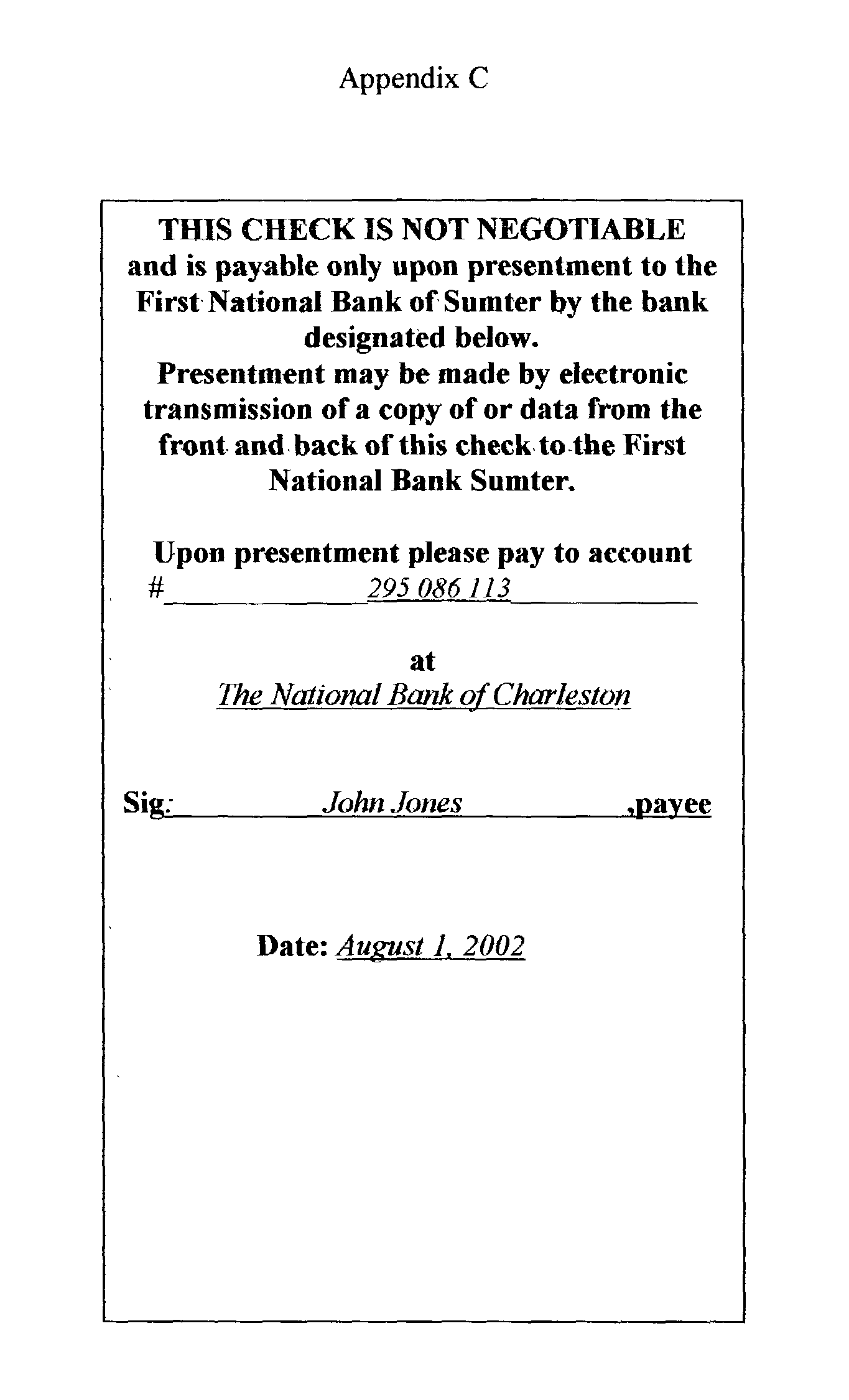

The system disclosed is for making payments using a new type of bank check combined with electronic funds transfer (EFT) facilities The new type check is not a negotiable instrument and is intended for delivery to the payor's bank rather than to the payee. The check instructs the payor's bank to make a payment by EFT from the payor's bank account directly to the bank account of the payee at the payee's bank, normally via the Federal Reserve's Automated Clearing House (ACH) facility. The system includes means for making a true, but inoperative, copy of each check at the time the check is written. Other embodiments of the invention are special checks, which look like conventional checks, but on their reverse sides display printed matter stating that they are non-negotiable and are payable only pursuant to special procedures.

Owner:ALLAN FREDERICK ALEY

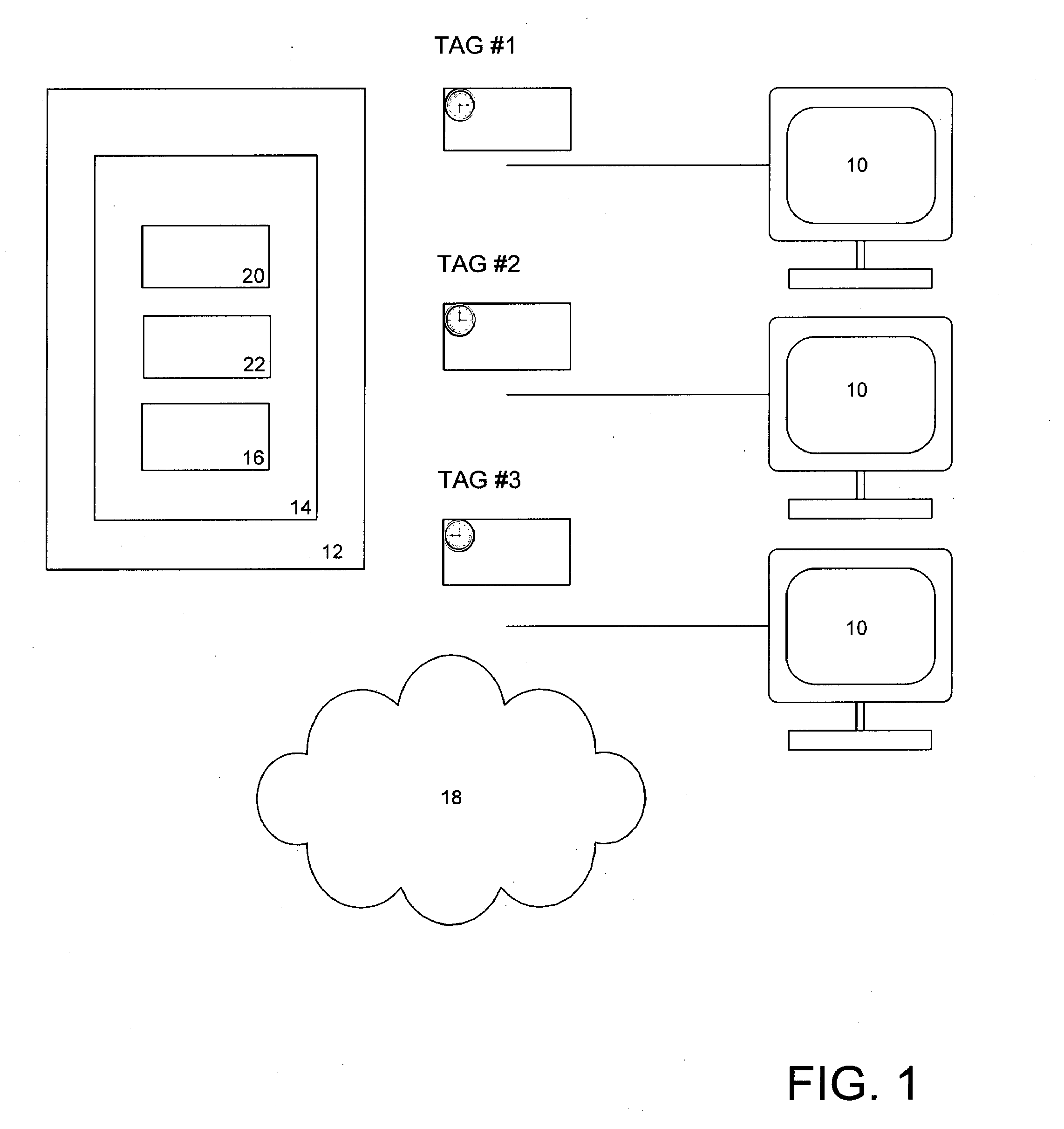

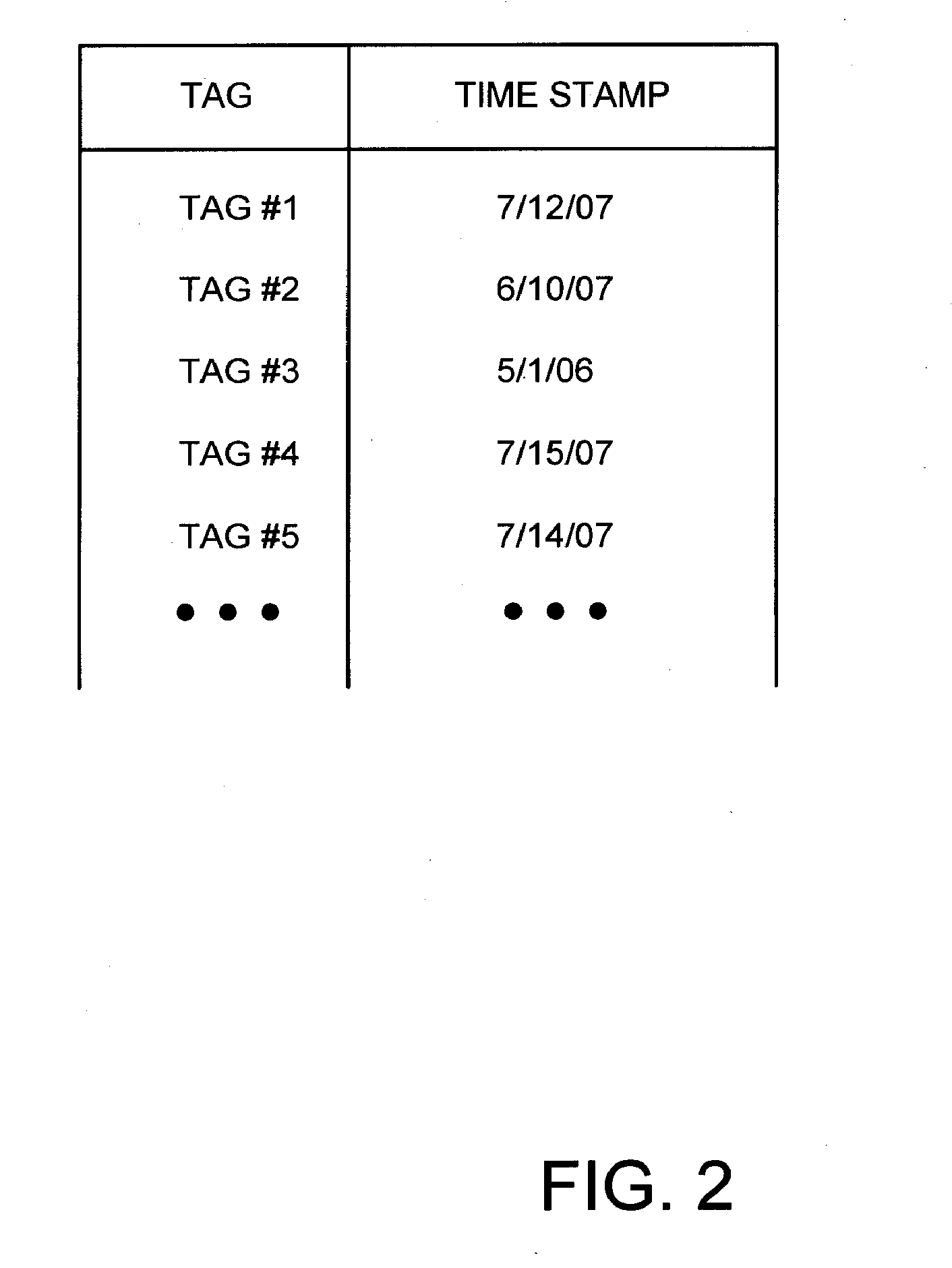

Methods and Apparatus for Detecting Fraud with Time Based Computer Tags

ActiveUS20090083184A1Detection of potentialPrevention of potentialComputer security arrangementsPayment architectureTemporal informationBank account

Systems and methods for creating and analyzing computer tag information for the prevention or detection of potential fraud. Computers and other devices accessing the Web carry device tags with date and time information describing when they were issued by a security tag server. A server time stamp may be inserted into time based computer tags such as a cookies indicating when they were created. Such time stamp information can be encrypted and analyzed during future attempts to access a secure network such as a customer attempting to log into an online banking account. When the time stamp information from the tag is compared to other selected information about the user, device and / or account, including but not limited to last account log-in date / time or account creation date, the invention may be used to detect suspicious activity.

Owner:THE 41ST PARAMETER

Bank account automatic adjustment system

InactiveUS20040177036A1More balancedMinimize as littleFinanceComputer security arrangementsDeposit accountBank account

The present system for automatically adjusting deposit balance is the effective measure for pay-off which calculates the excess amount by subtracting from the balance of the account established in one financial institution, the specified balance for the account and calculates the allowable amount by subtracting from the specified balance for the account established in other financial institution, the balance of the account and compares said excess amount with said allowable amount and sets the transfer amounts as the one lesser of either said excess amount or said allowable amount. Specifically the system for automatically adjusting deposit sets in addition the plus specified balance for checking and savings accounts and time deposit account respectively when said accounts include checking account and savings account and time deposit accounts. The system for automatically adjusting deposit further sets the minus specified balance for the debt amount. Preferably the system for automatically adjusting deposit is an apparatus which enables to maintain the necessary balance and calculates the deficit amount by subtracting from the balance for the account established in one financial institution, the necessary balance for the account and calculates the surplus amount by subtracting from the necessary balance for the account established in said other financial institution, the balance for the account and compares said deficit amount with the surplus amount and sets the amount that is lesser of said deficit or surplus amounts for the transfer amount.

Owner:NUTAHARA ATSUO +1

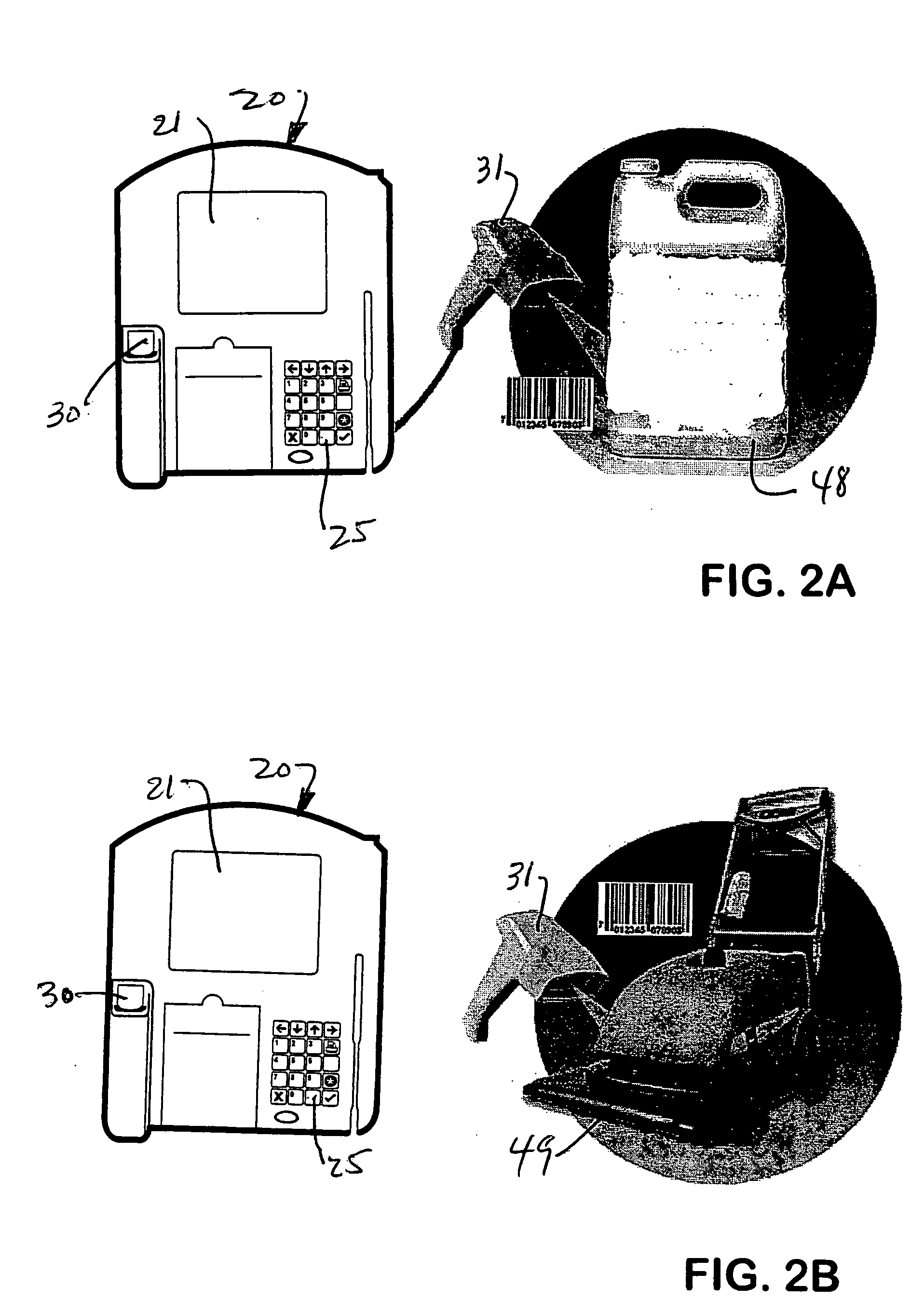

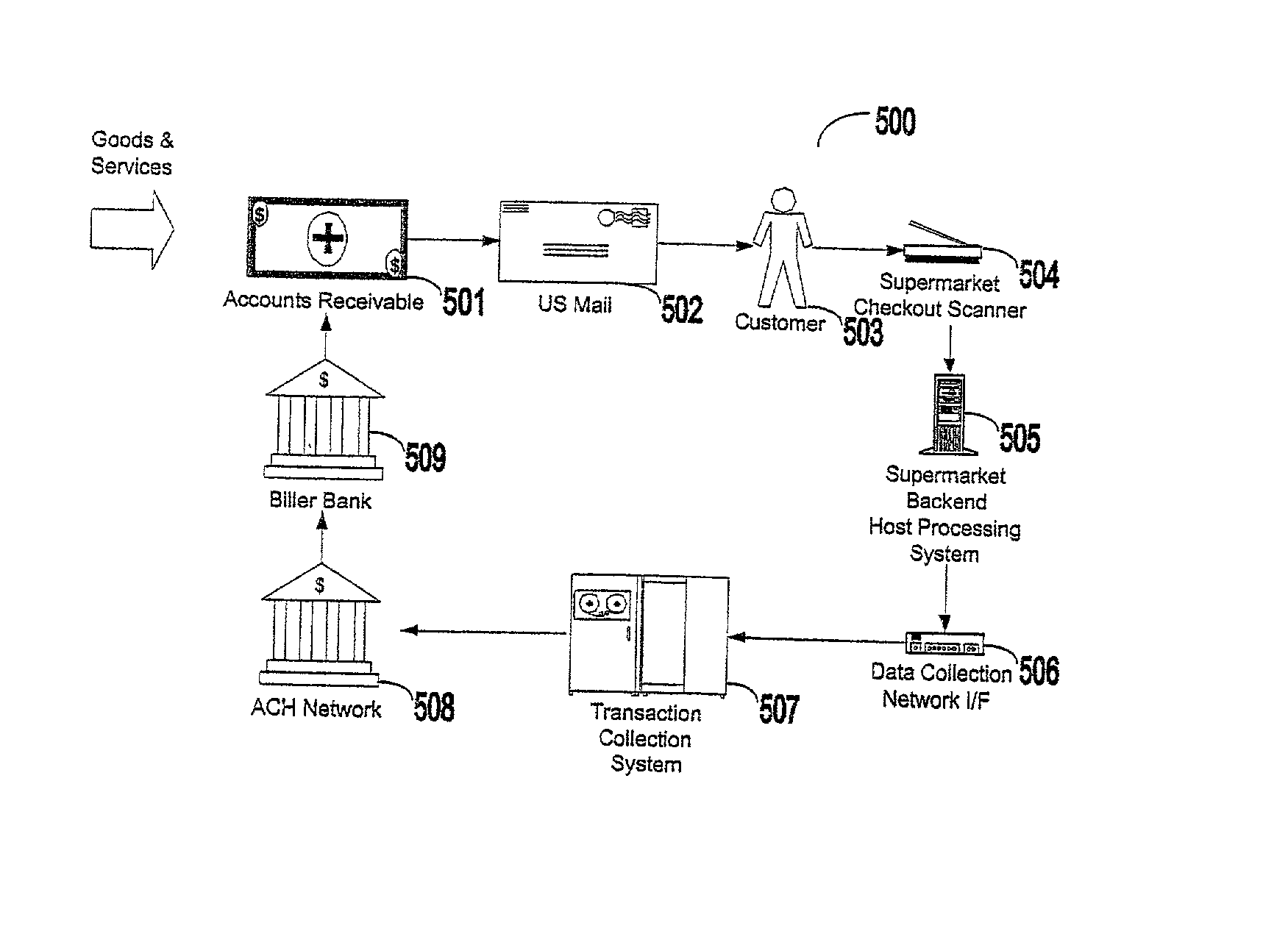

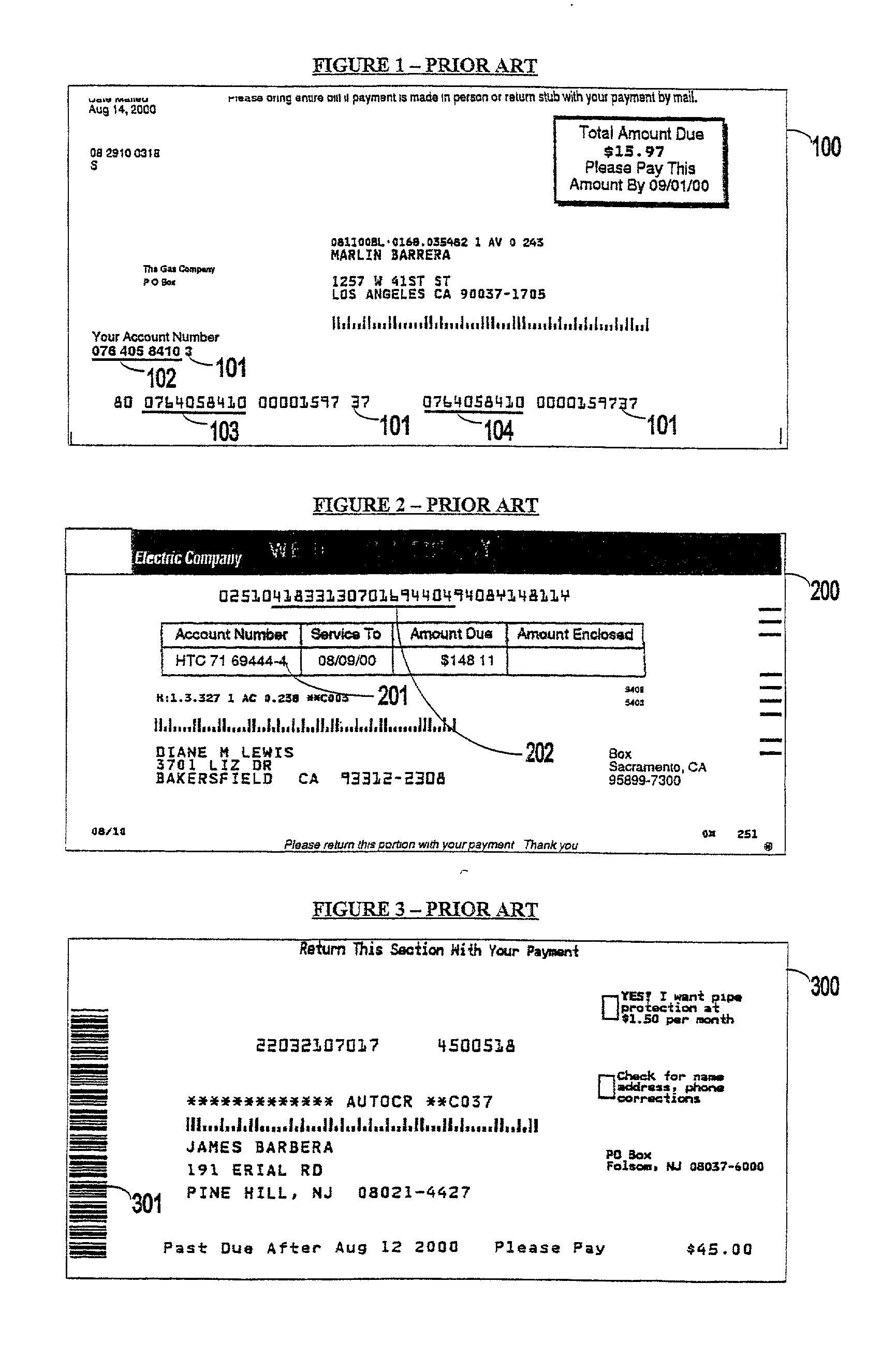

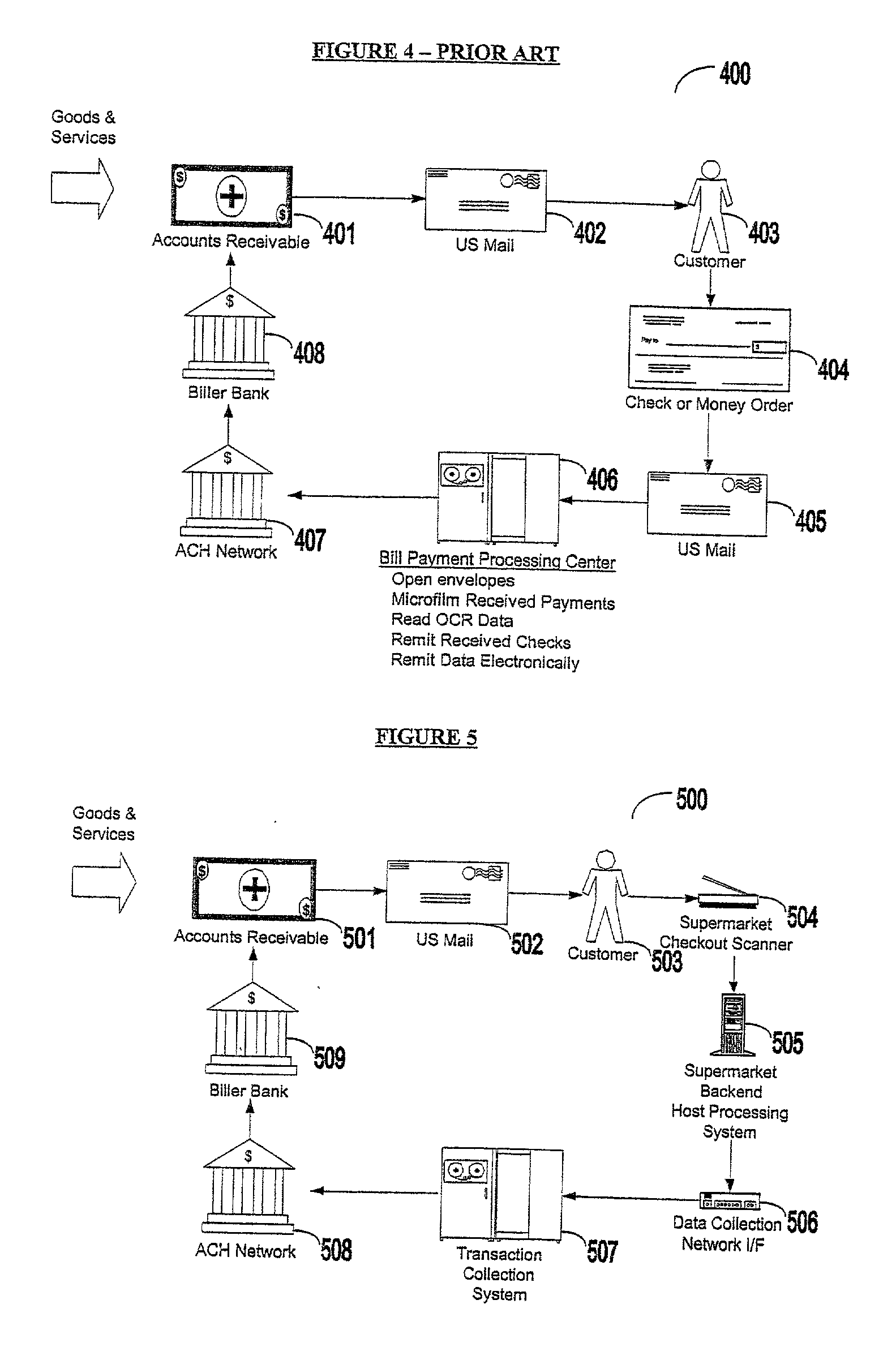

Bar coded bill payment system and method

InactiveUS20020128967A1Inexpensively and easily established and maintainedPay their bills more efficientlyFinancePayment protocolsBank accountBarcode

A system and method for payment is provided, wherein consumers pay their bills at supermarkets, large retail chain, or other stores and receive immediate credit from billers for their payments. Payments are made using a bar code printed on the bill or sent to the consumer, e.g., by fax or email. The biller receives good payment funds, deposited directly into his bank account, and error-free electronic payment data for consumer bill payments by the very next business day. The biller backdates the received bill payments to the time and date the consumer actually paid, regardless of the time that the payment data takes to post to the biller's accounts receivable system. In another aspect, a method for person-to-person money transfers is provided, wherein a bar coded deposit slip, card, or other printout permits a sender to remit finds directly into a receiver's bank account, and such funds are quickly accessible for withdrawal at a nearby automated teller machine, or for a debit card purchase.

Owner:PAYSCAN AMERICA

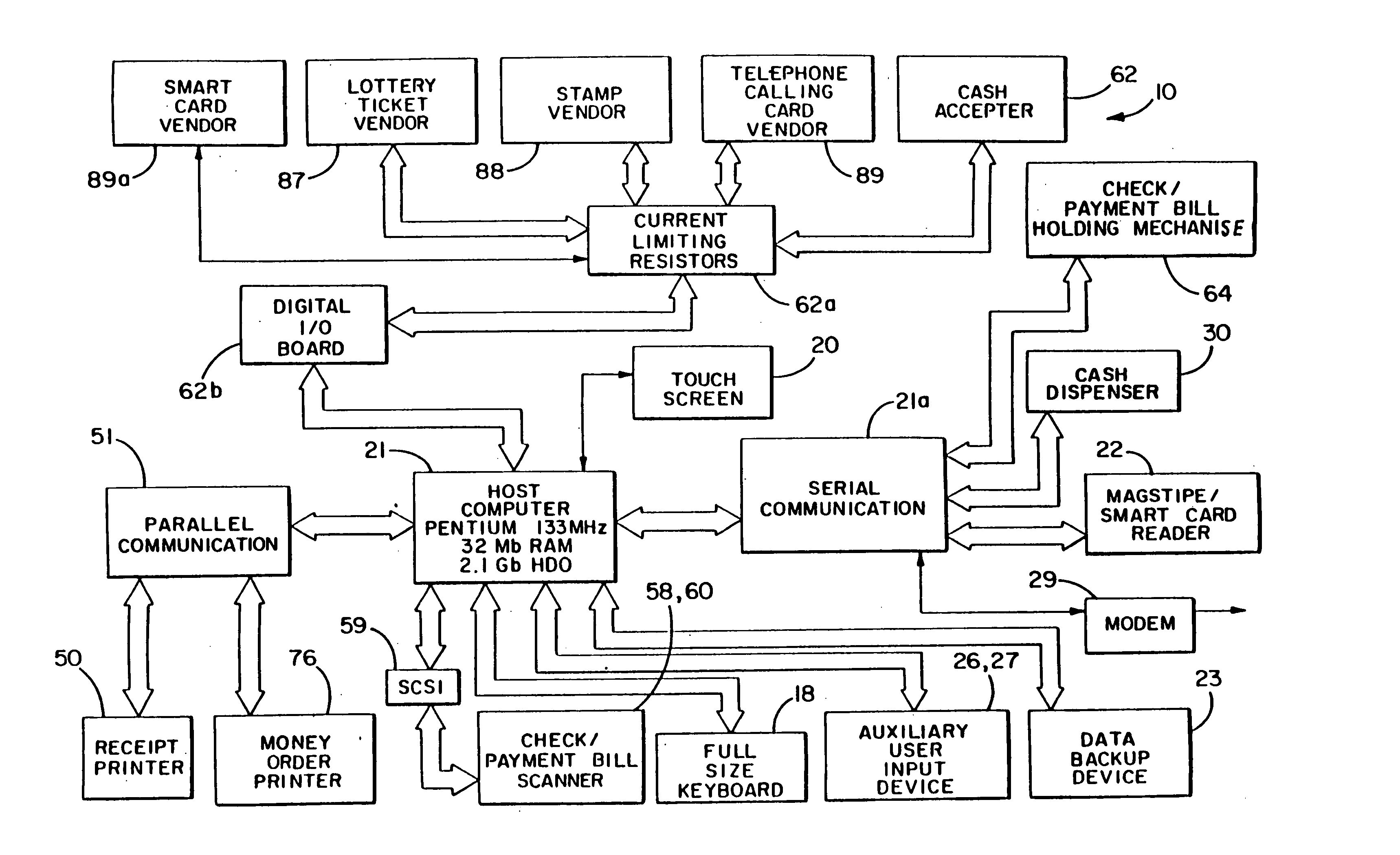

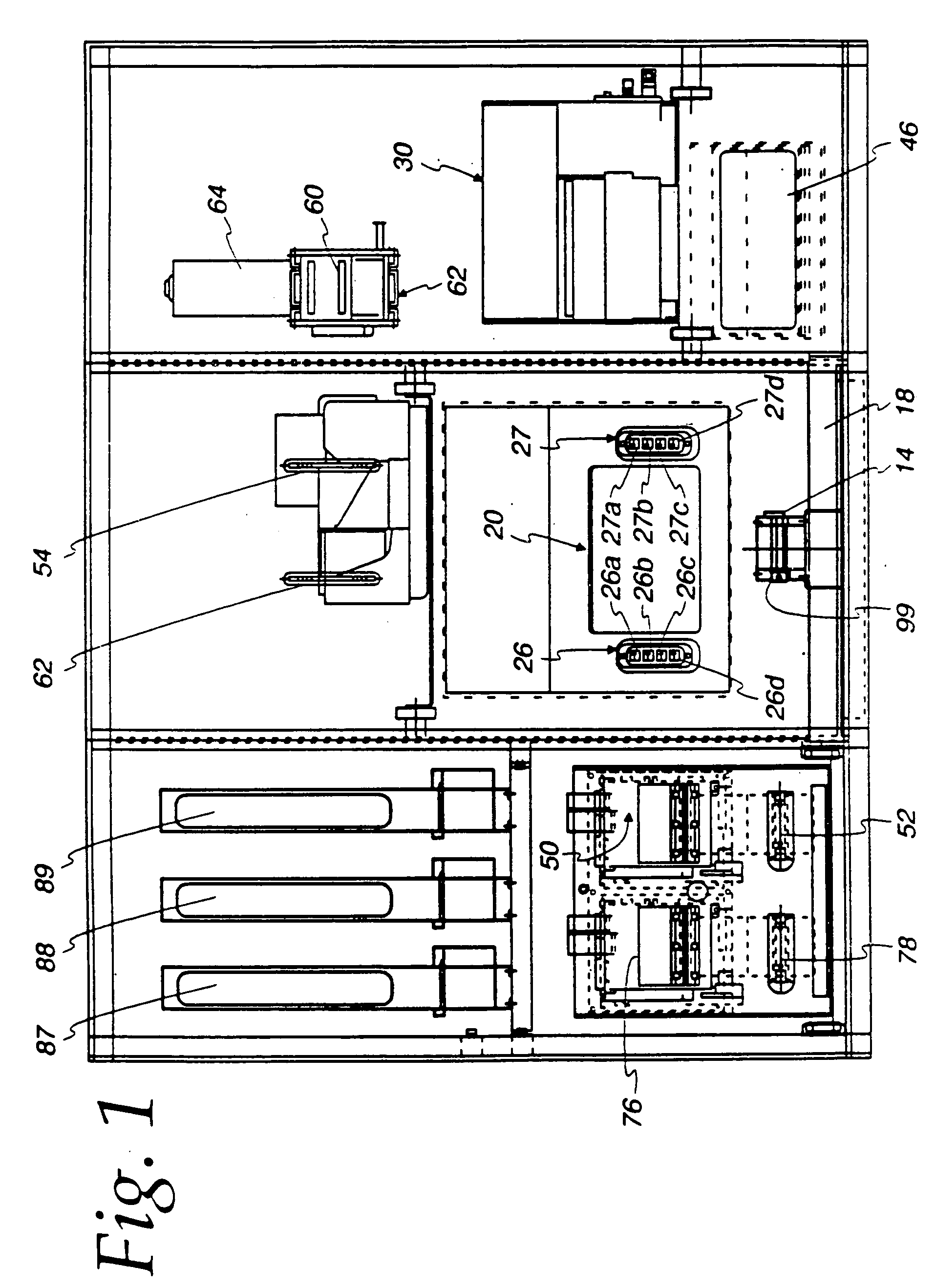

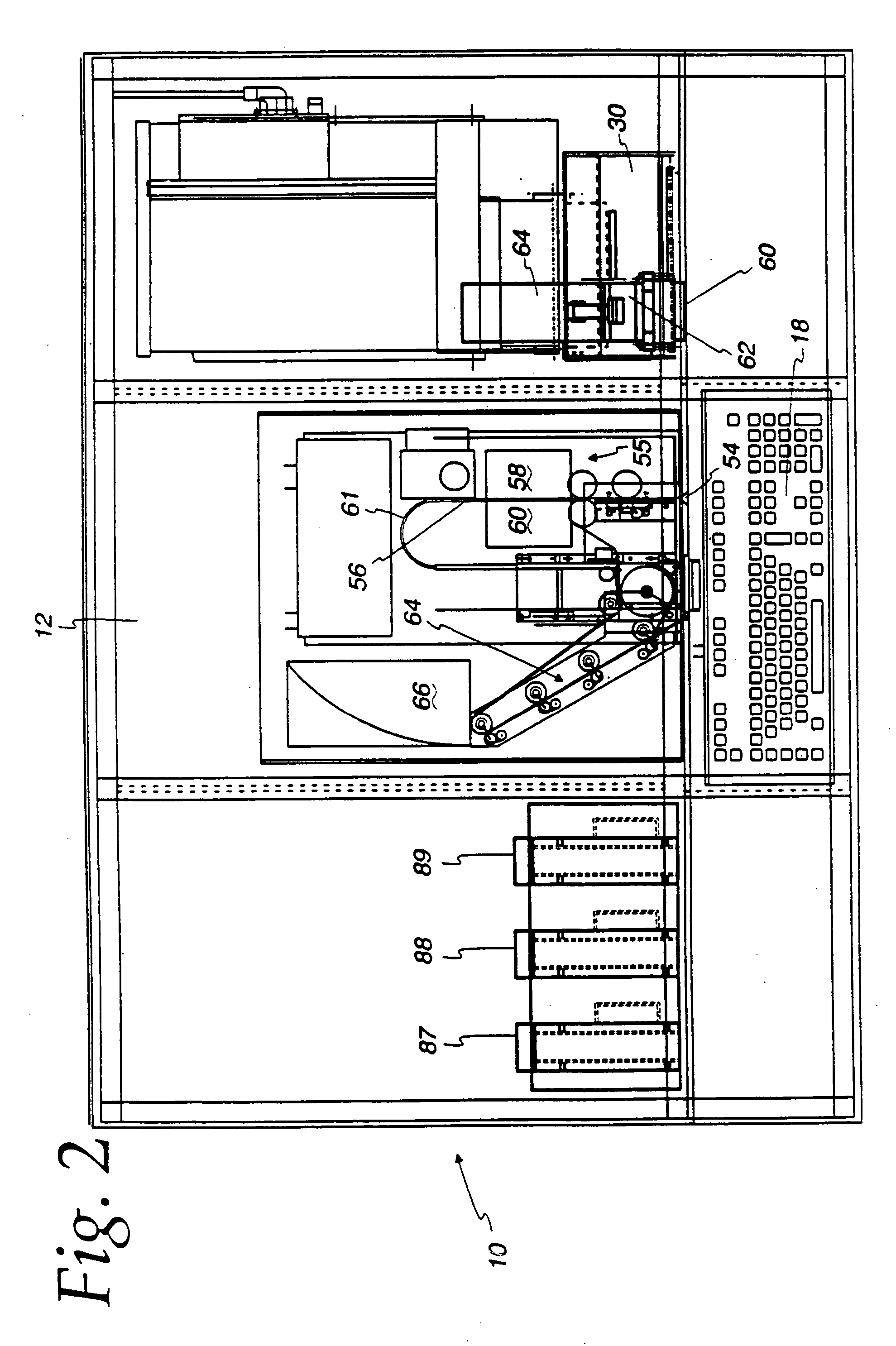

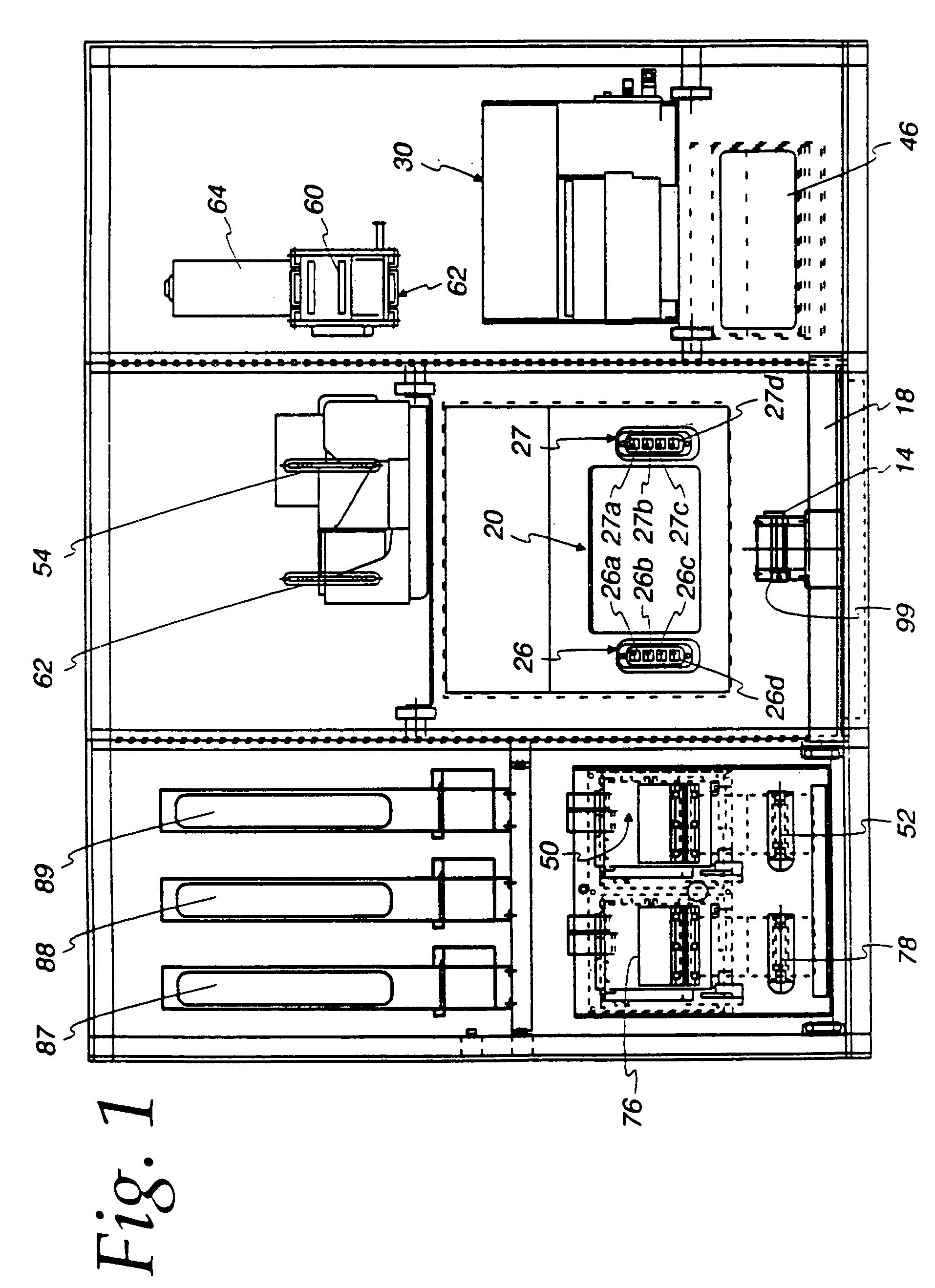

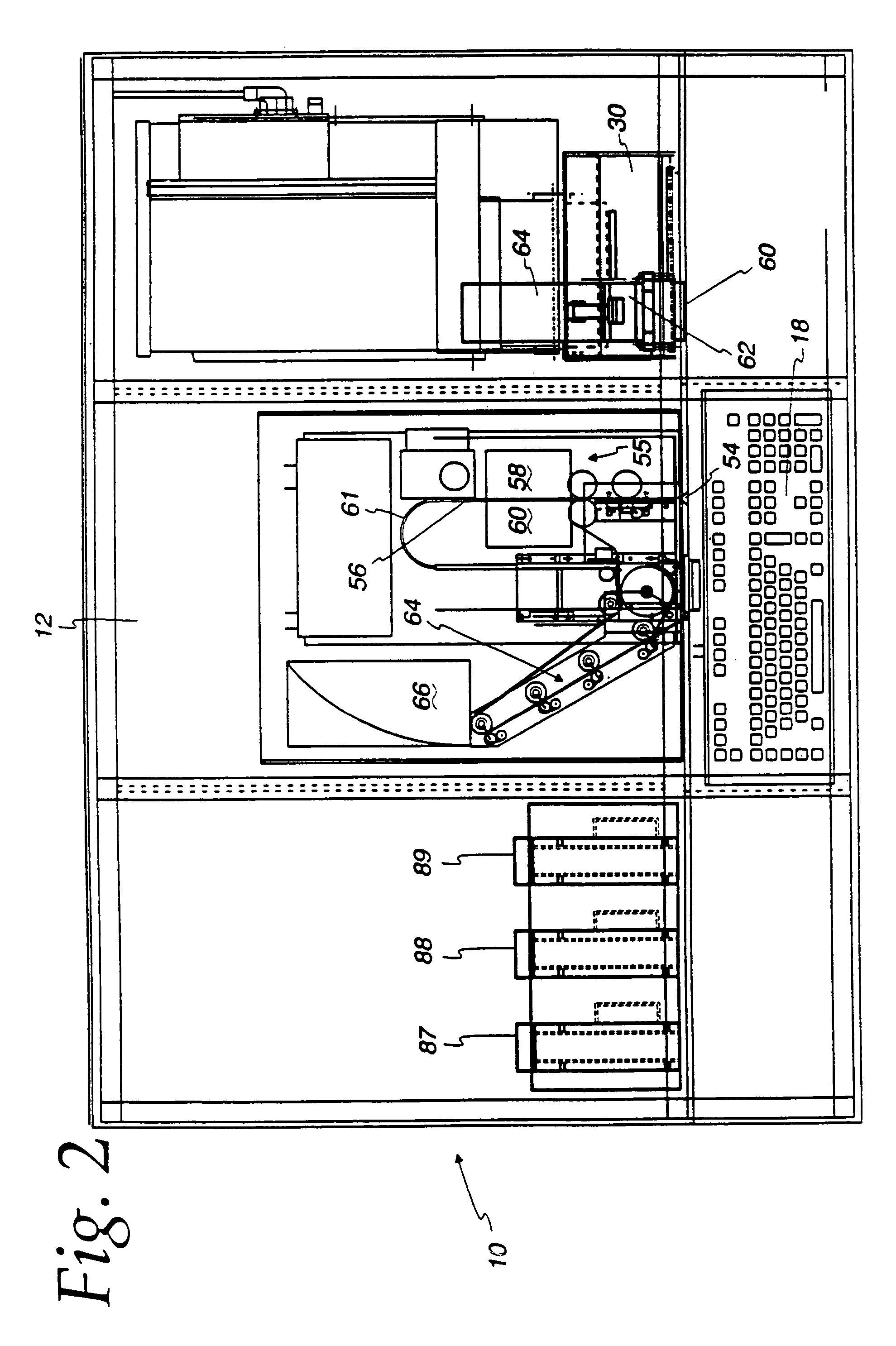

Automated document cashing system

An automated document cashing system is provided with an automated machine that cashes monetary transaction documents such as checks, money orders, and that makes deposit entries into the bank account of the user after validation of the user and monetary transaction document, without the aid of a bank teller. Validation of the identity of the user is performed with the use of a card associated with intelligence that identifies the user. A biometric device also may be used in identifying the validity of the user. Validation of the document involves one or more of: validating the presence of a signature; validating the amount of the monetary transaction document including a manual entry of the amount by the user; validating CAR against the LAR; and validating the banking system parameters and rules for the customer and / or the transaction. To assist in the automatic analysis of data on monetary transactional documents or on remittance documents, the user is prompted to provide a bounding box about the data. An image touch screen may be touched by the user to locate the bounding box and the user may magnify the data to fill the boundary box to exclude other data from this analysis. After document and person validation, the system will dispense money or transfer monies to a savings account, a checking account, a smart card, or the like. The system will also write money orders or wire transfer money. By supplying monies in the form of cash, credit card authorization, smart card balance, or the like to the machine, the user can pay bills such as a utility bill through the system or purchase items dispensed by the system.

Owner:UTILX CORP +2

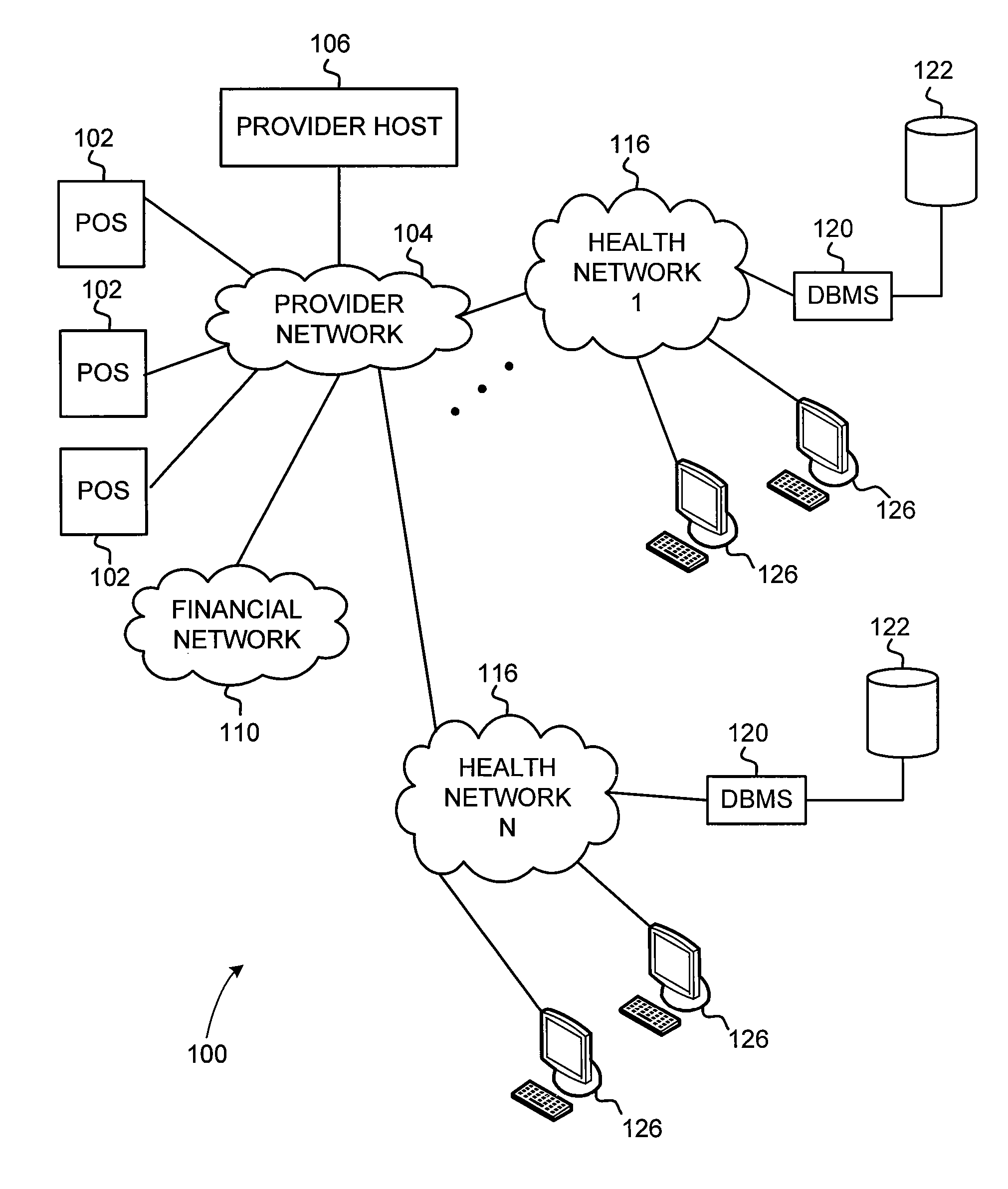

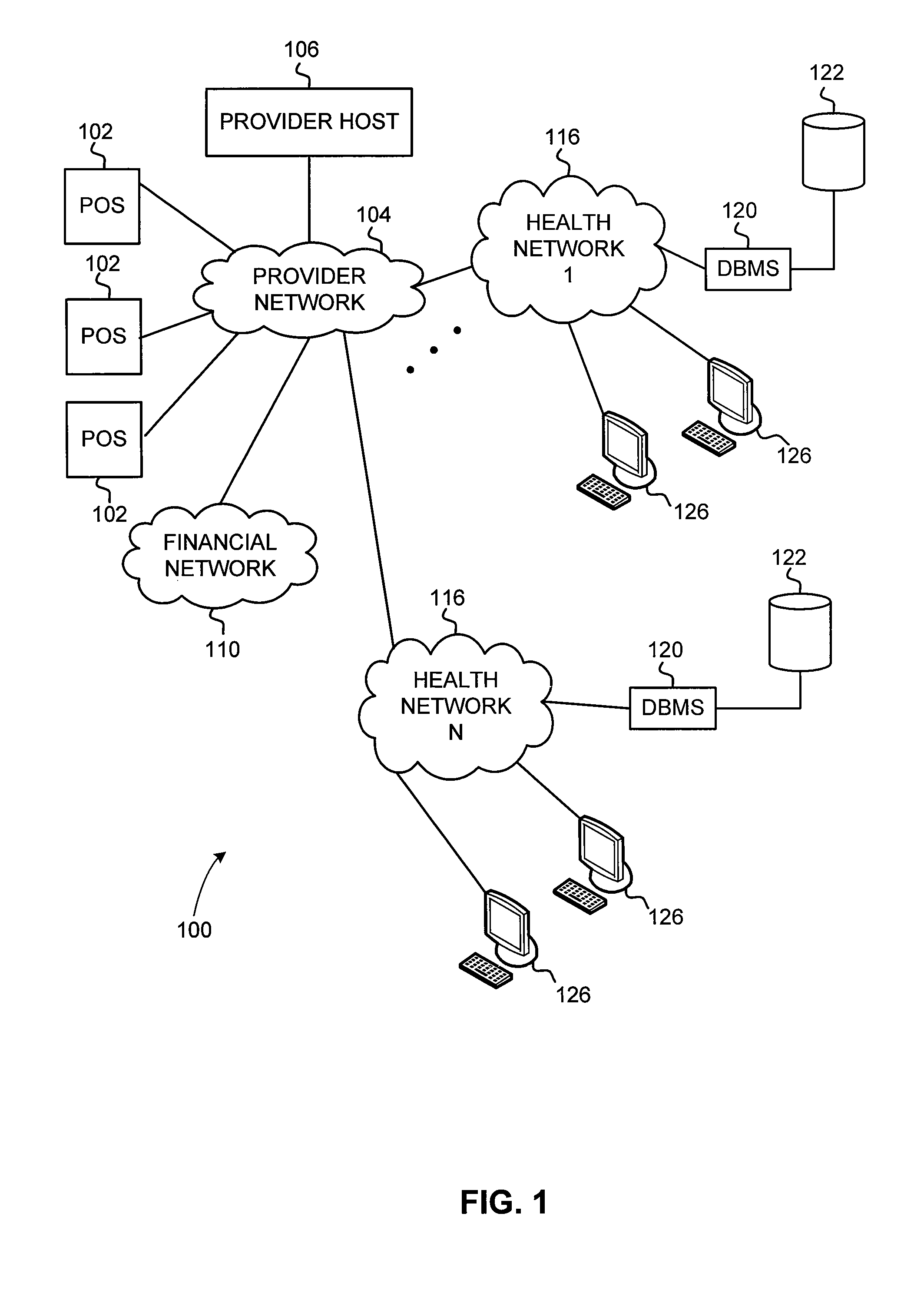

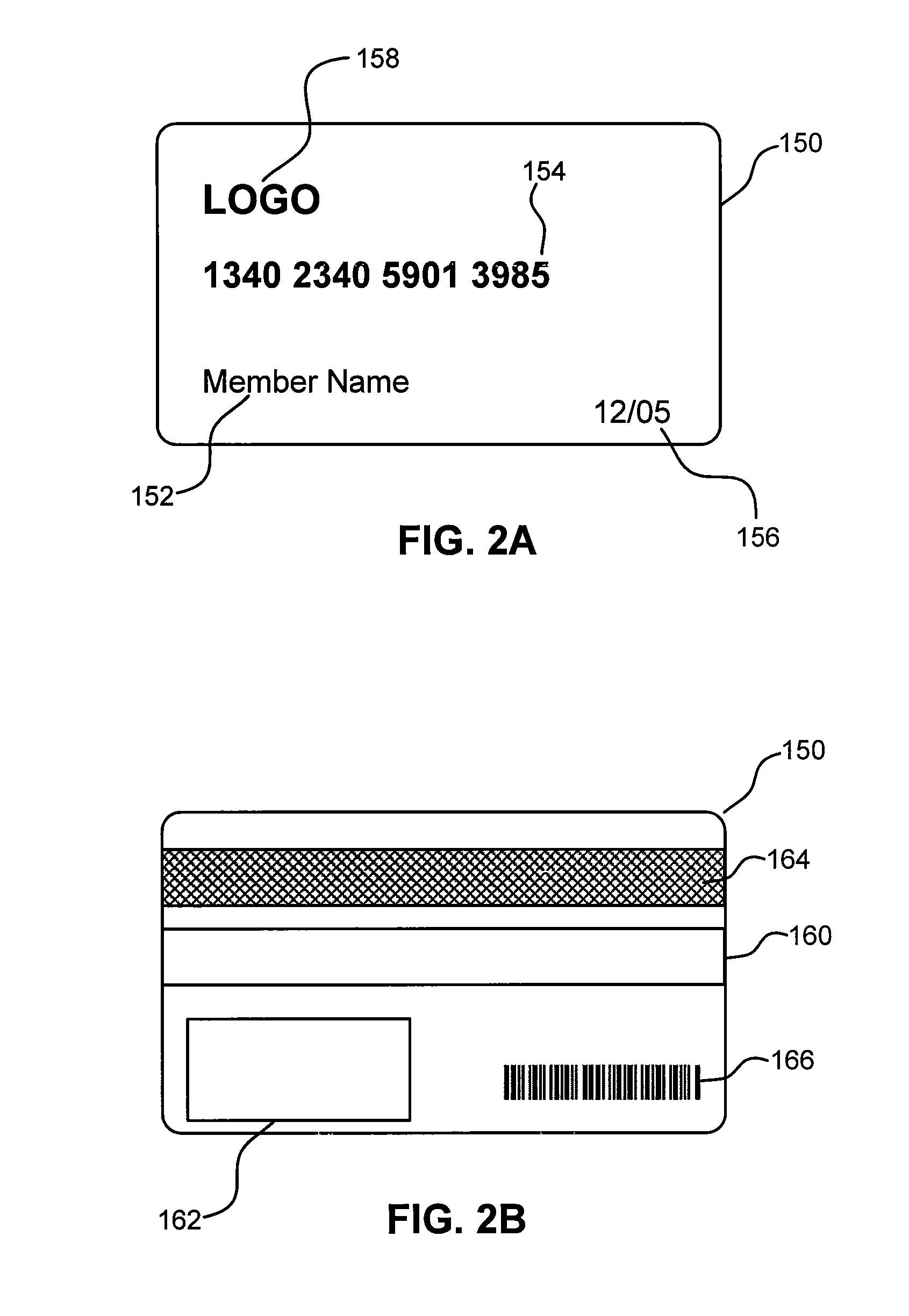

Healthcare system and method for real-time claims adjudication and payment

A system and method for permitting real-time payment of healthcare charges from multiple sources of payment. A POS terminal is used to enter a patient ID and treatment code. A health insurance network receives the patient ID and treatment code and returns an electronic explanation of benefits (EOB) data packet that is used to display an EOB statement at the POS terminal, the display including information on a patient portion not covered by the health insurance plan. The EOB data packet is used to electronically process payment for the patient portion from a second payment source, such as an medical savings account (MSA), credit card account or banking account.

Owner:FIRST DATA

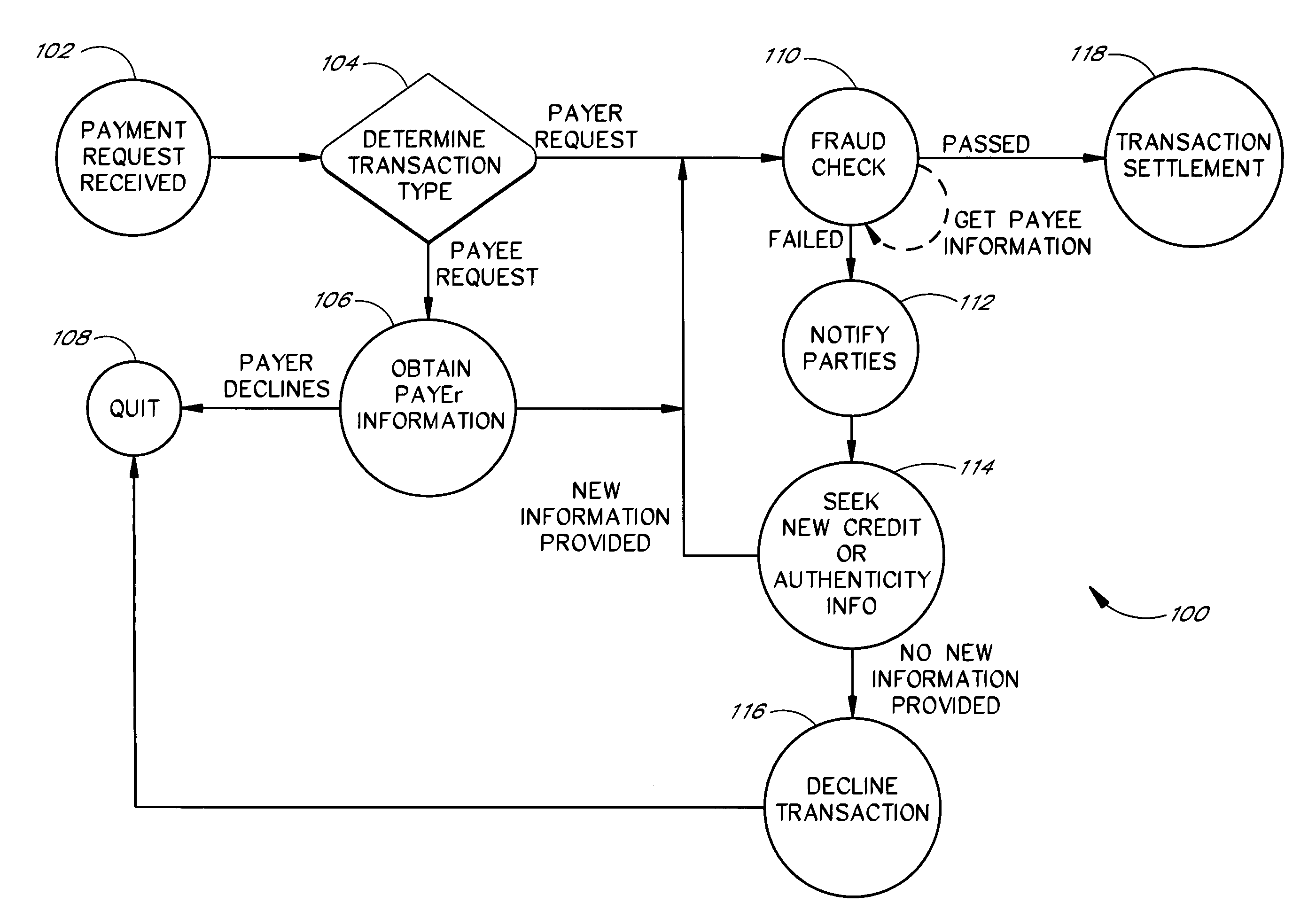

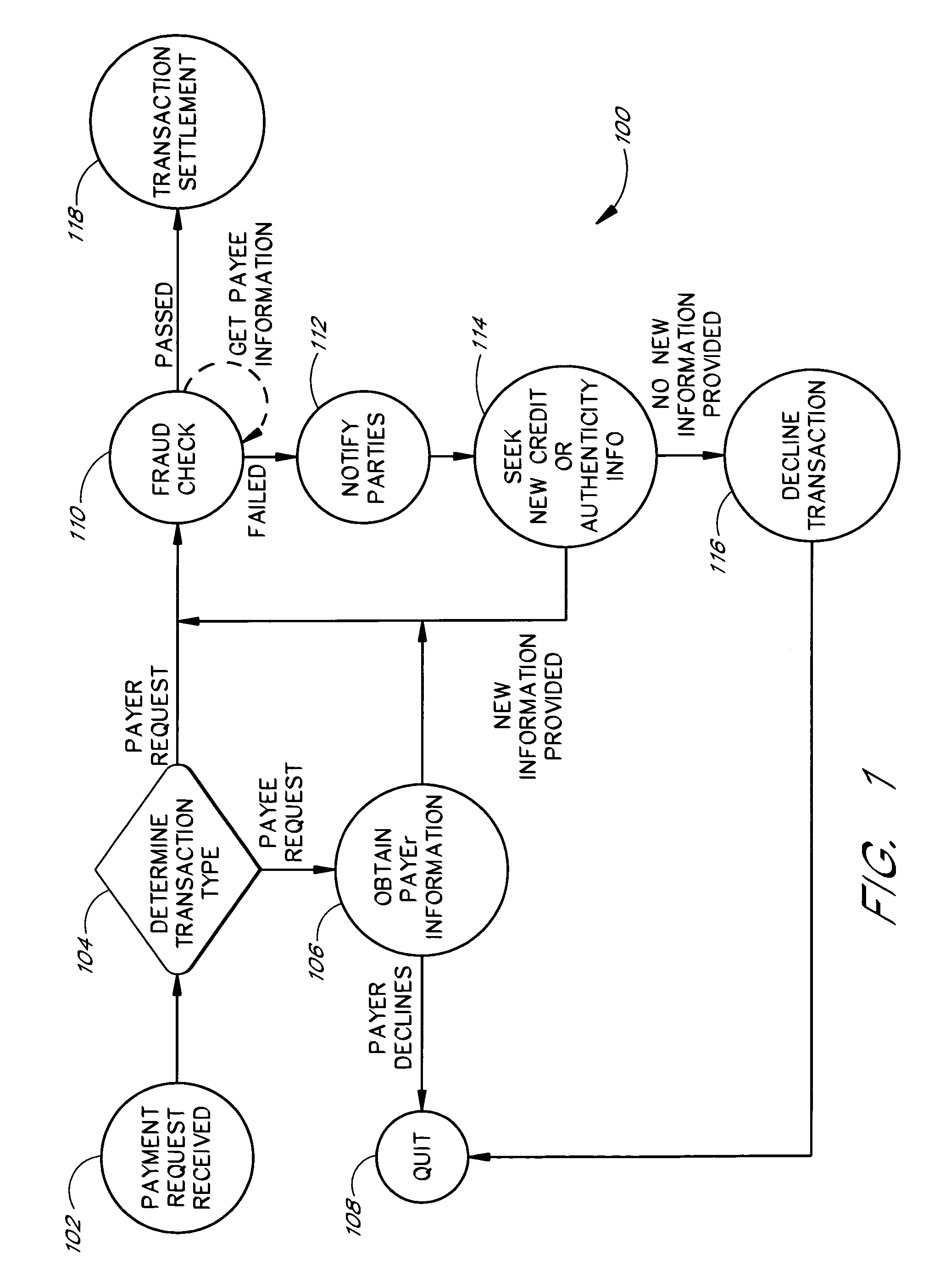

Computer-assisted funds transfer system

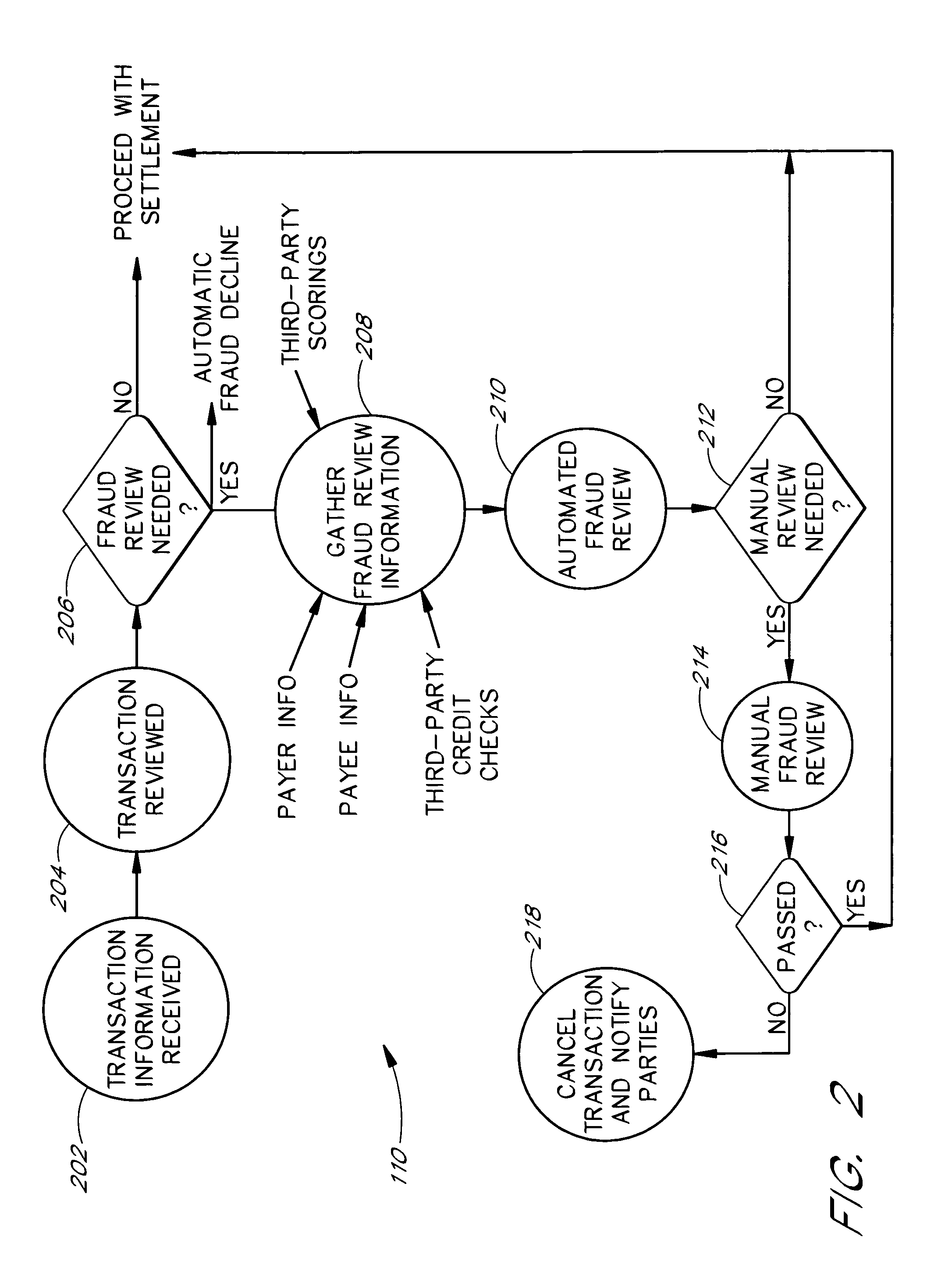

A payment request associated with a transfer of funds is received and a risk management assessment for both sides thereof is performed. If the risk management assessment procedure produces an adverse indication, the payment request is declined. Otherwise, the payment request may be processed for delivery of a payment associated therewith. The risk management assessment may be performed on the basis of credit / authentication information derived from customer information received with (or even prior to) the payment request. Such customer information may include credit card account information and / or bank account information (e.g., checking account) information. In some cases, the risk management assessment may include an automated component and a manual (non-automated) component. Such a manual component may be needed where the automated component of the risk management assessment provides suspect information regarding one of the parties to the transaction. Where the payment request is processed for delivery of the payment, such processing may include submitting a payment authorization request, and, upon receiving a settlement indication regarding that payment authorization request, transmitting the payment. In some cases, the payment may be transmitted as a check, while in others it may be transmitted as a money order or instruction to have funds automatically deposited in an account.

Owner:AMAZON TECH INC +1

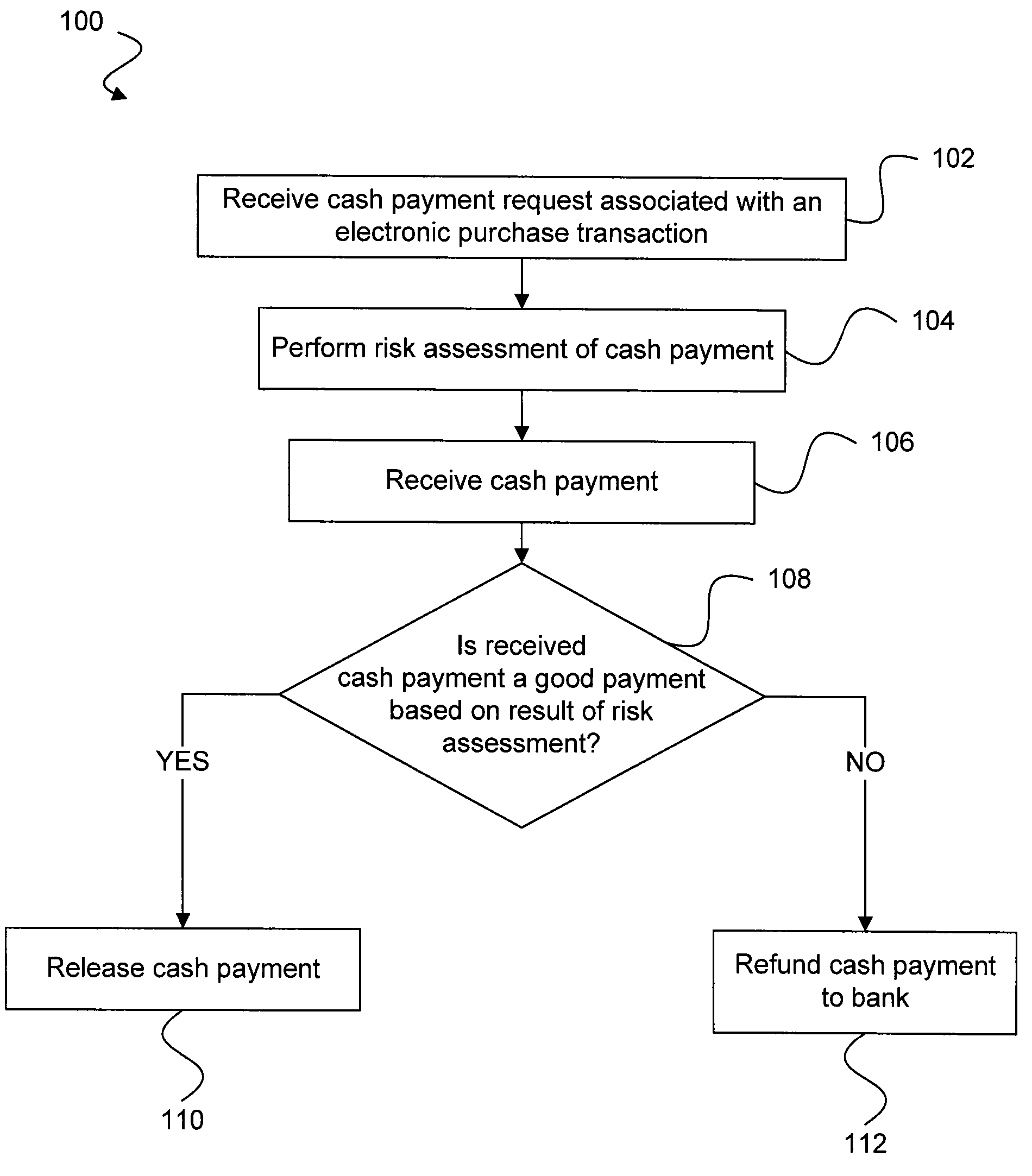

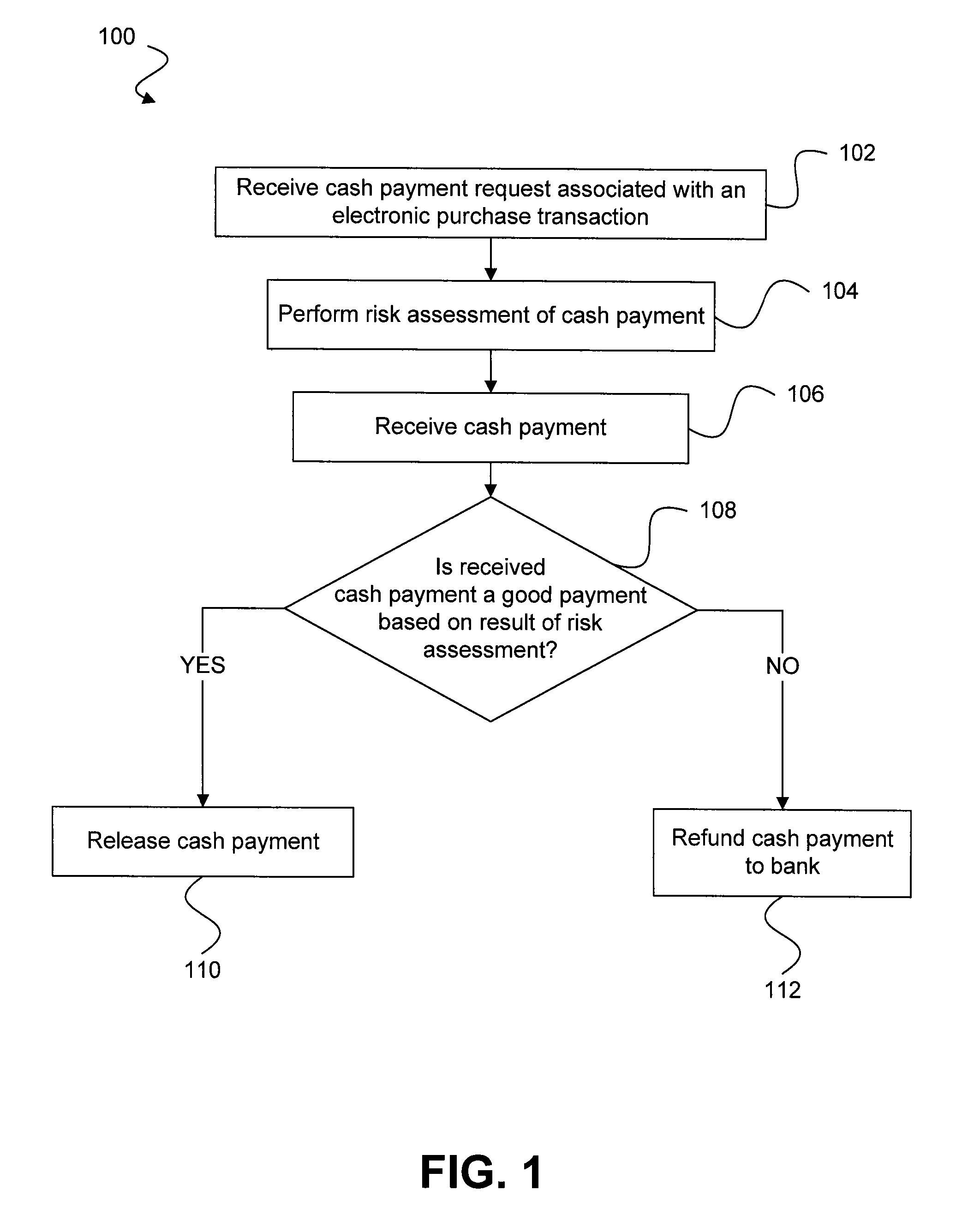

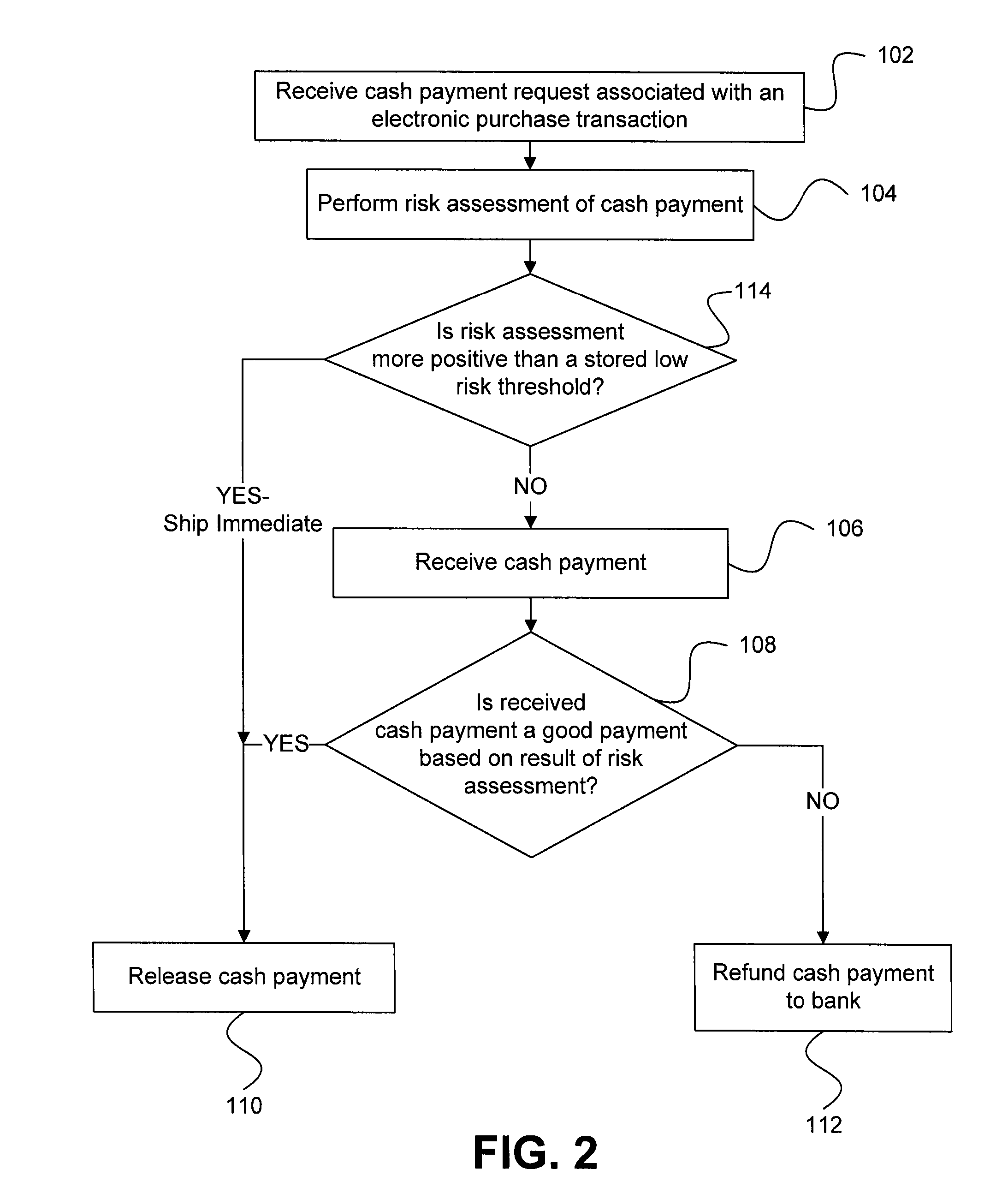

Risk detection and assessment of cash payment for electronic purchase transactions

A system and methods are provided which allow consumers to pay for ecommerce transactions through online bill payment and for merchants to determine that payments are not fraudulent. The system and methods do not rely on personal or confidential customer information relating to credit-cards and / or bank account routing information, date of birth and / or social security number. A risk manager can perform risk assessment for the cash payment based on order information and non-confidential purchaser information included in a cash payment request. In response to receiving an indication of the cash payment from the purchaser, a determination is made whether the cash payment is a good payment based on the risk assessment. The cash payment is released to a merchant in response to a determination that the cash payment is a good payment.

Owner:WESTERN UNION FINANCIAL SERVICES

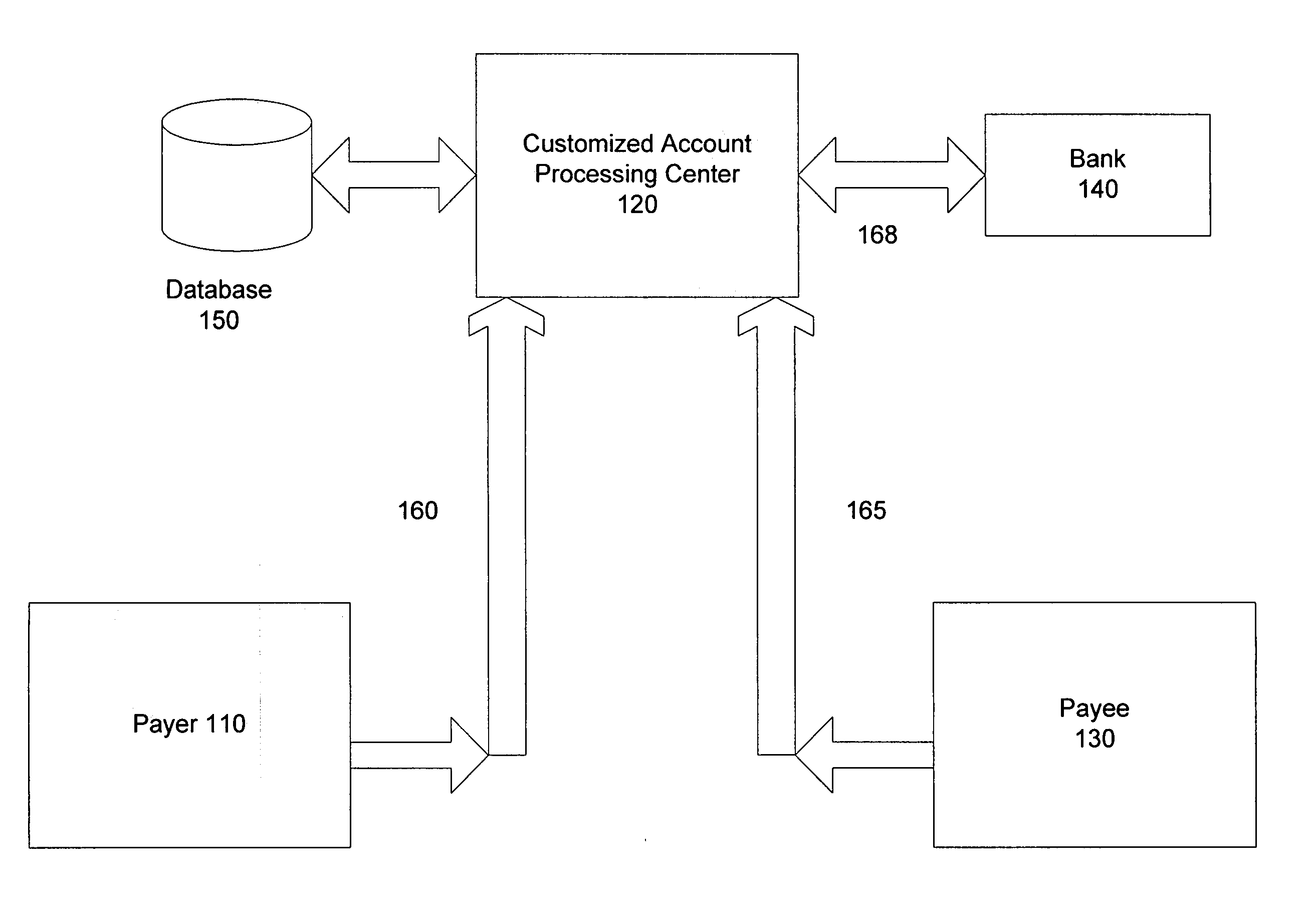

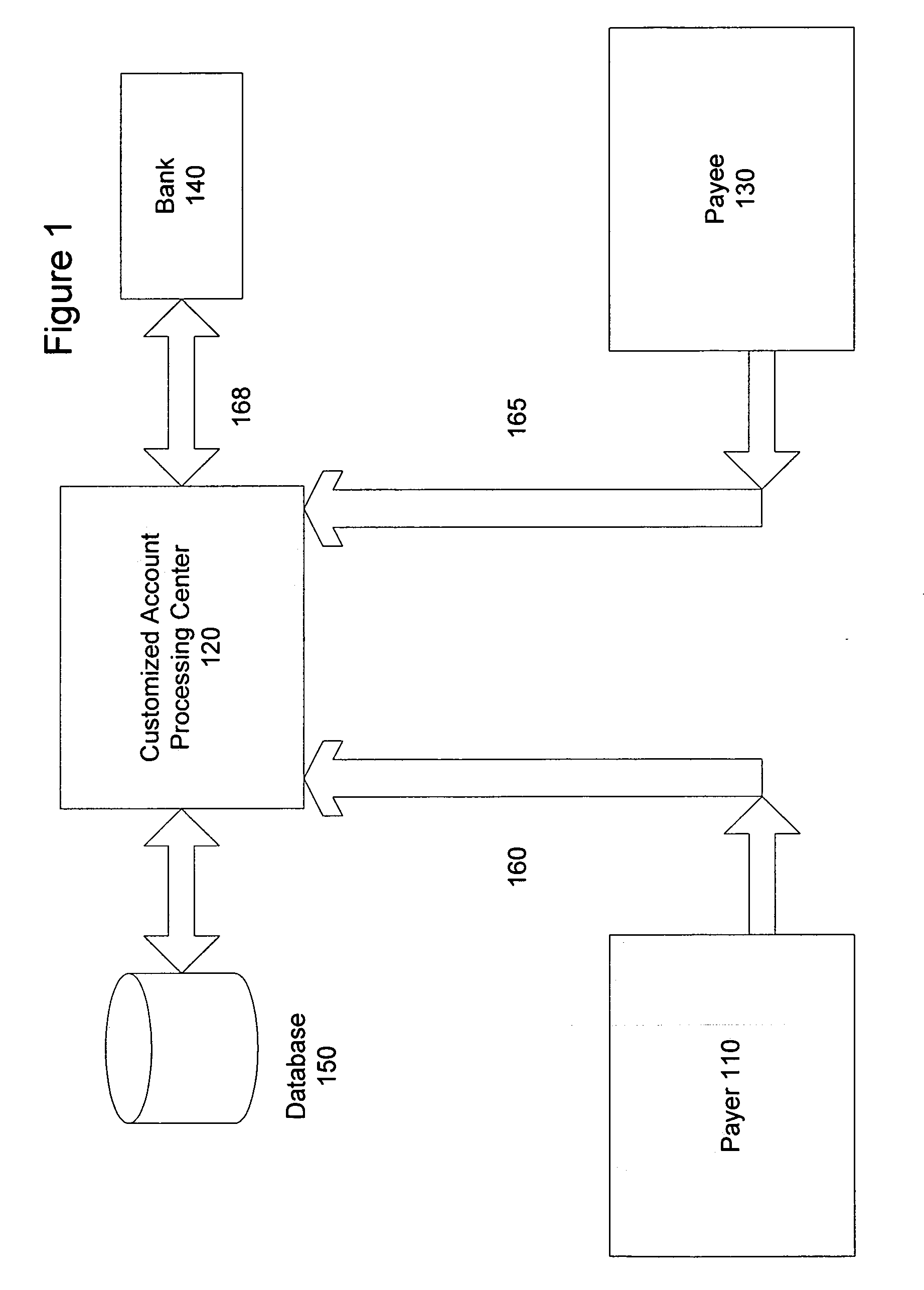

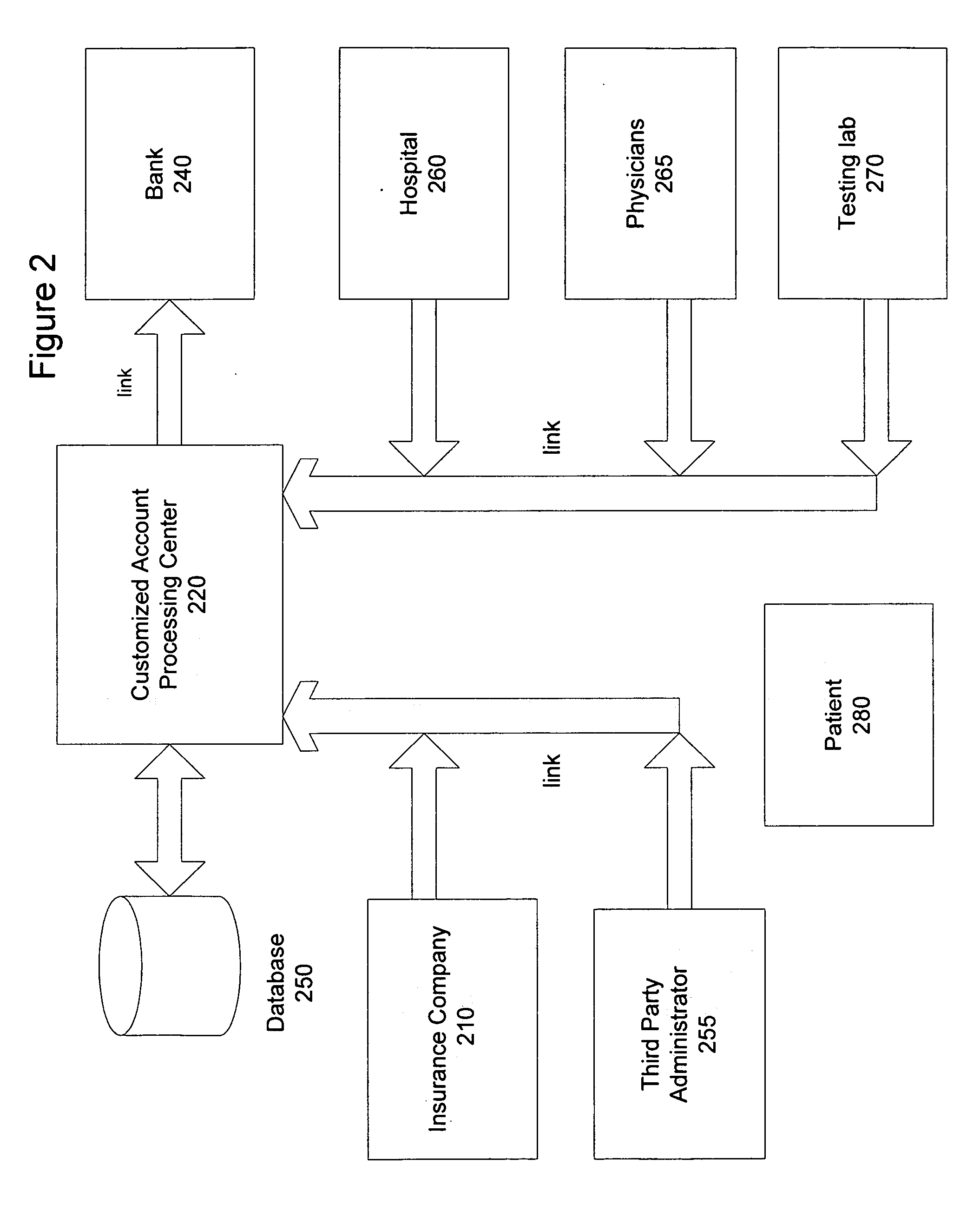

Customizable payment system and method

InactiveUS20060282381A1Avoid errorsPrevent fraudulent transactionFinanceBilling/invoicingBank accountComputer science

Owner:PAYFORMANCE CORP

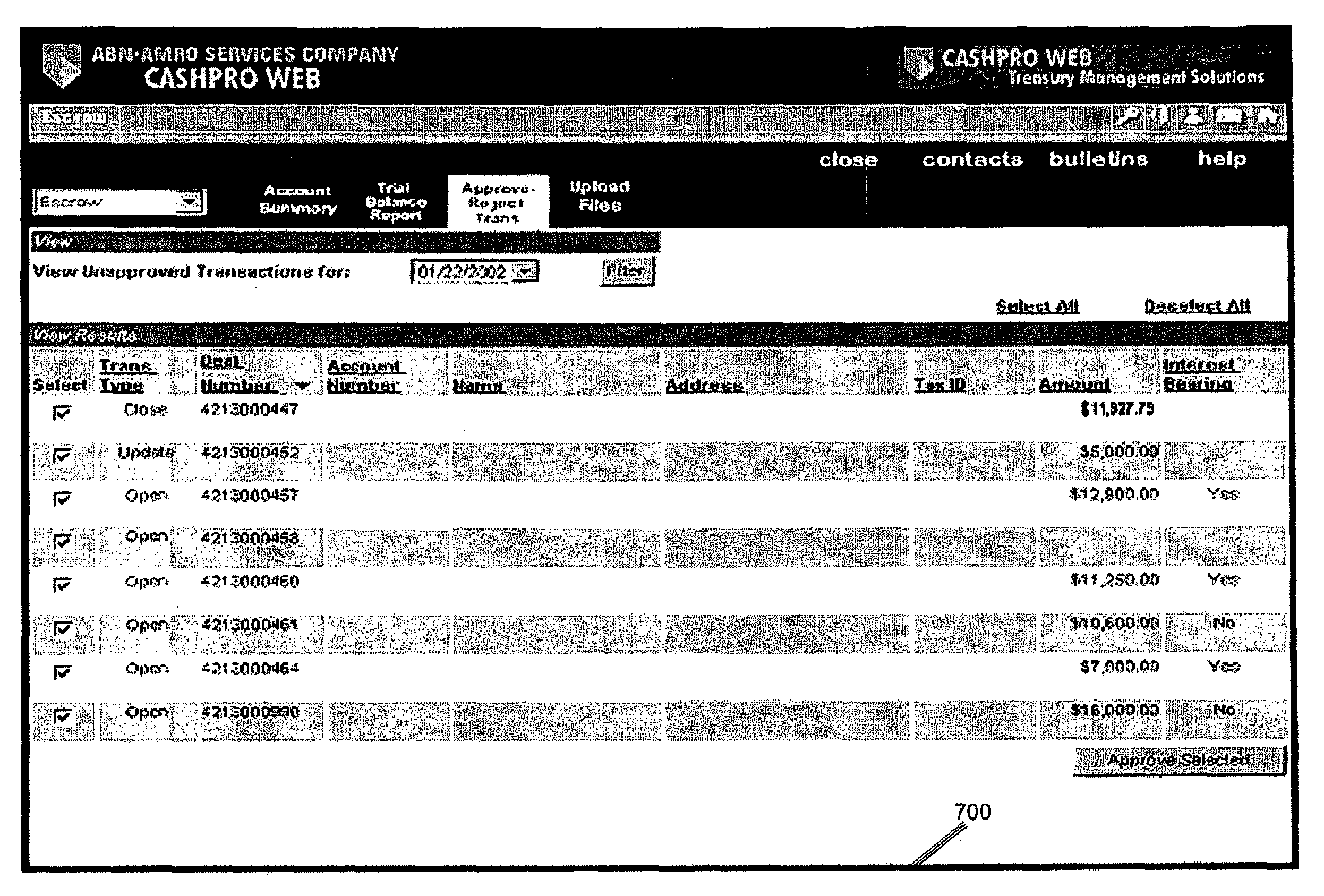

System and method for automated account management

InactiveUS7493282B2Eliminating capacity issueCost effectiveFinancePayment architectureBank accountCheque

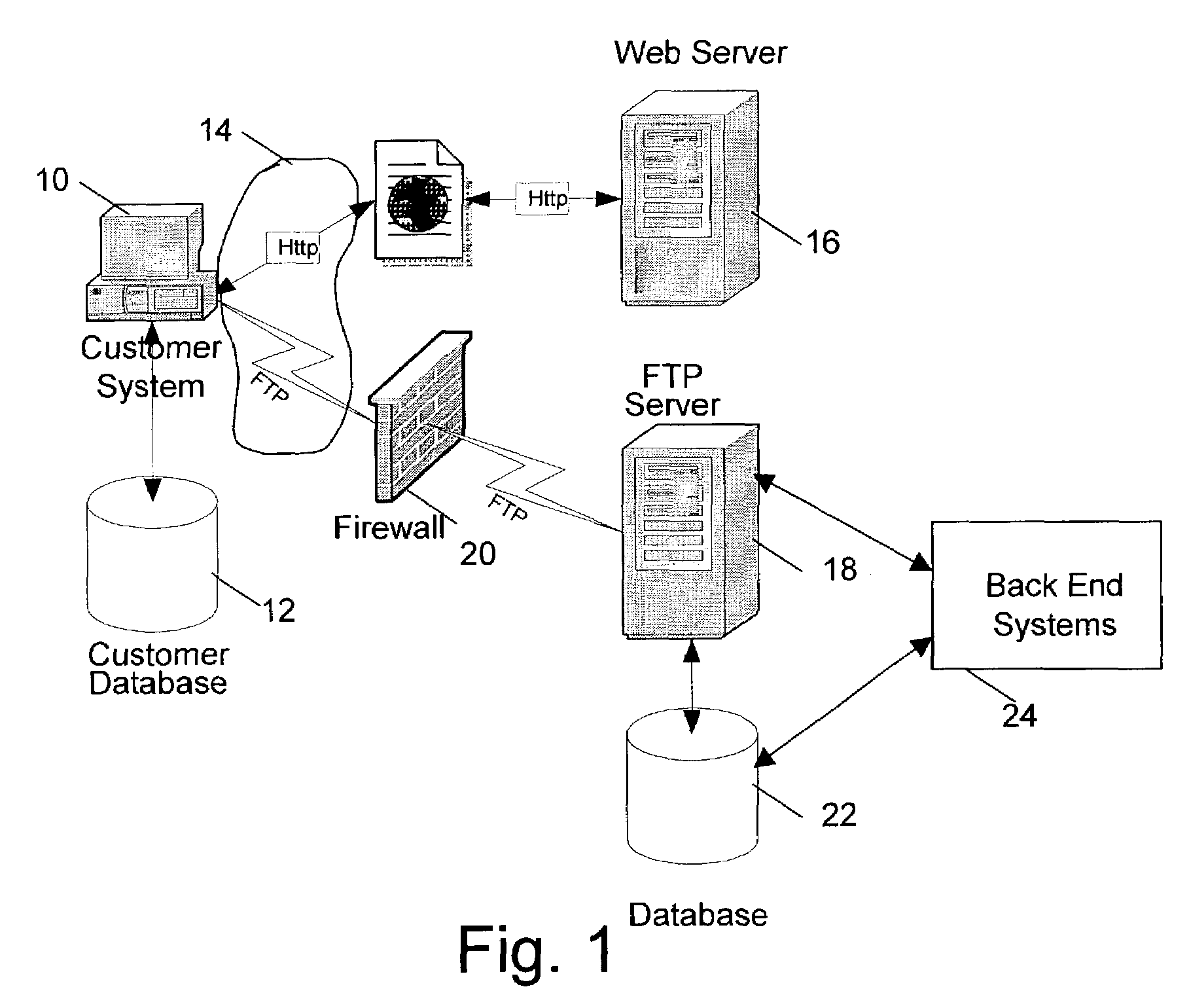

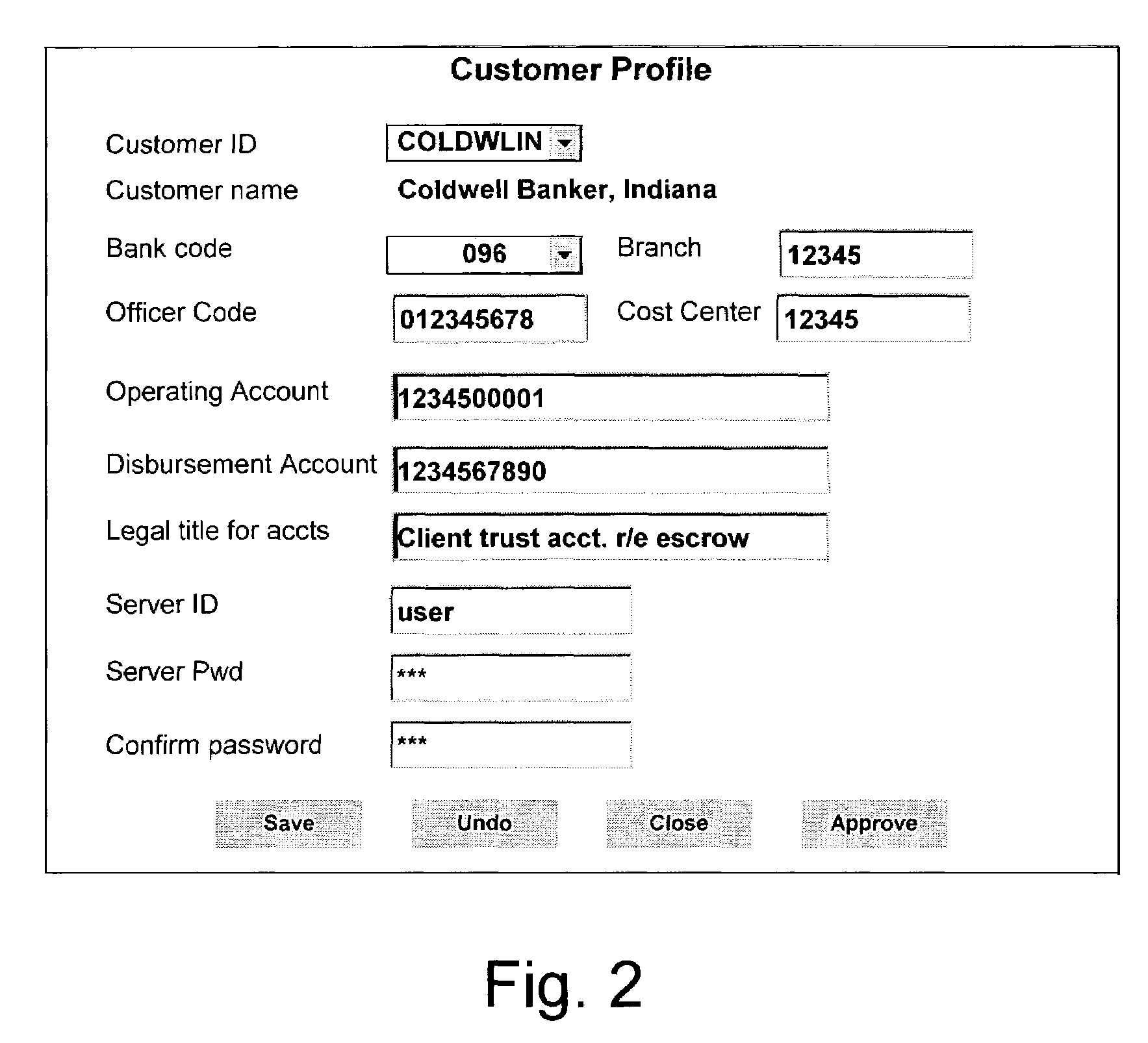

A system and method of managing bank accounts. A bank receives, electronically, from a customer, instructions to open, to update, to debit / credit, and to close bank accounts, such as escrow accounts associated with real estate transactions. Information in the instructions is used to automatically populate a bank's account management system. New accounts are thereafter automatically established and open accounts are automatically updated and closed consistent with the information in the instructions. New accounts are preferably funded from an operating account belonging to the customer, and checks are caused to be cut in an amount due to a client of the customer, if they so choose.

Owner:LASALLE ABN AMRO SERVICES CO INC

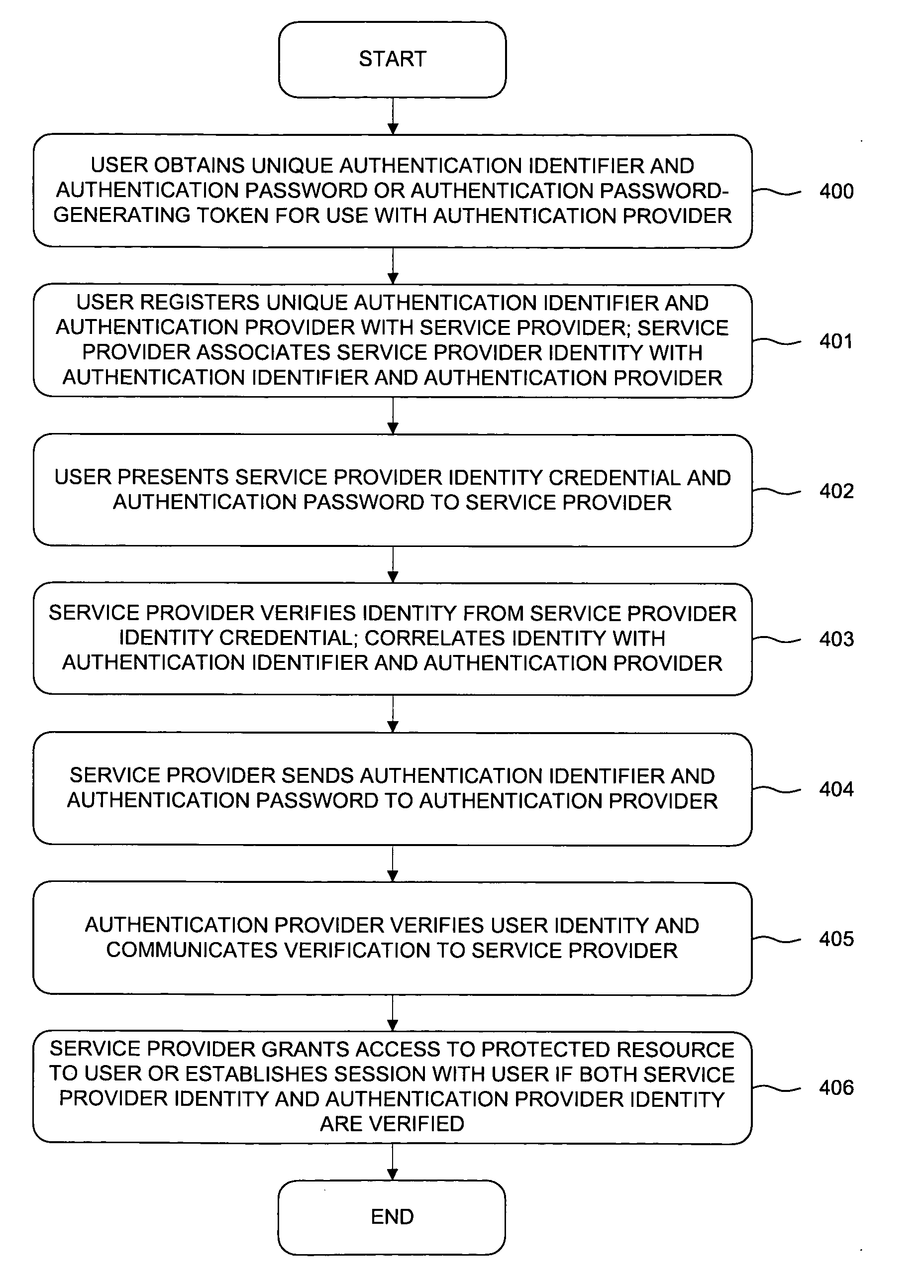

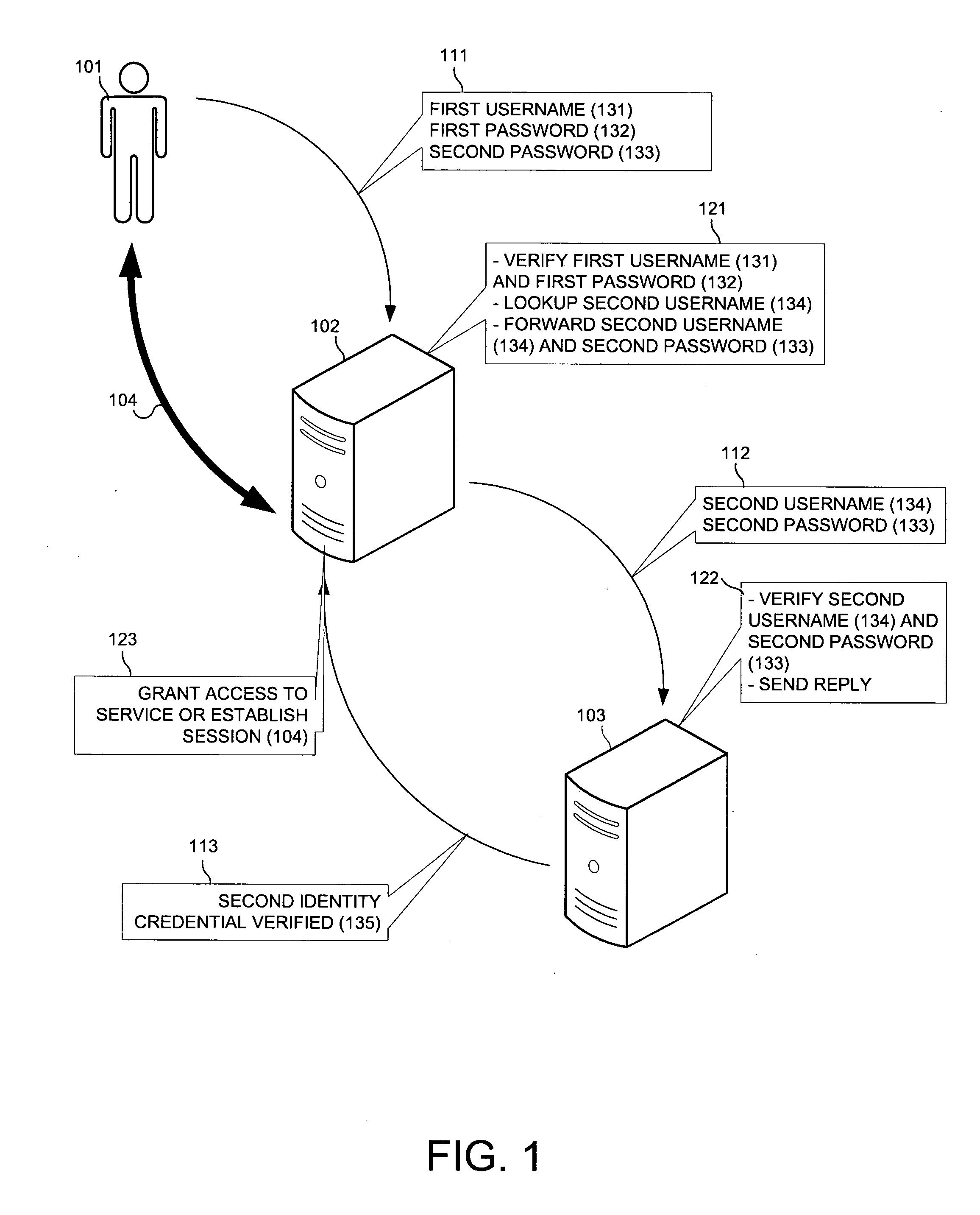

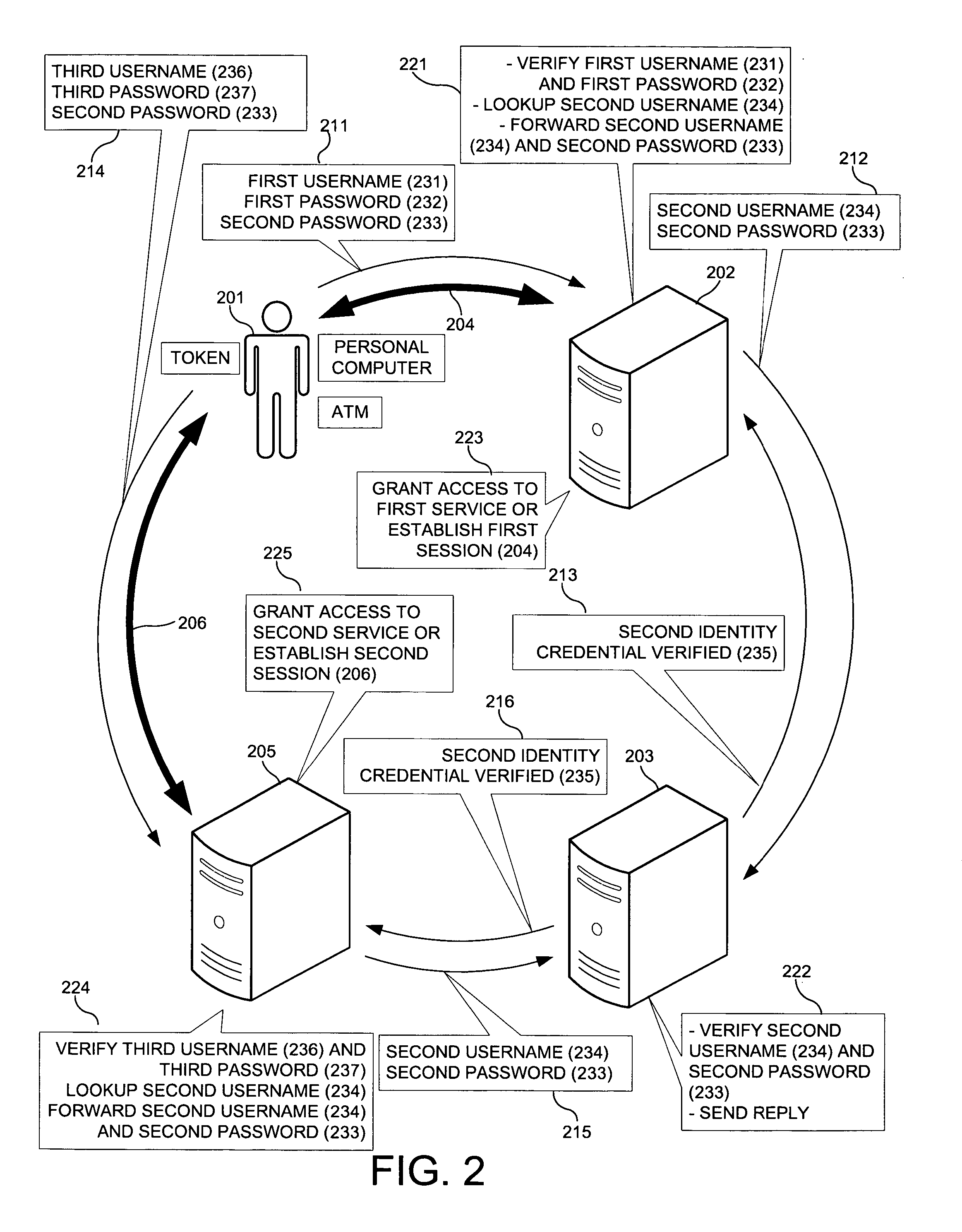

Third party authentication of an electronic transaction

A first identity credential (for example, a username and password), in conjunction with a second identity credential (for example, a token identifier and a token-generated password) verified by an authentication provider, permits access to a protected resource (for example, a bank account) maintained by a service provider (for example, a bank) where the service provider is a separate entity from the authentication provider. Such separation of the service provider from the authentication provider allows multiple service providers to use the same authentication provider such that subscribers of services from multiple service providers may register a single authentication provider, and thus use a single method to produce the second identity credential. An authentication provider provides a common validation service to a plurality of unrelated service providers. An electronic user interface and a key-chain token for carrying out the authentication process are also disclosed.

Owner:CHUA BRYAN S M

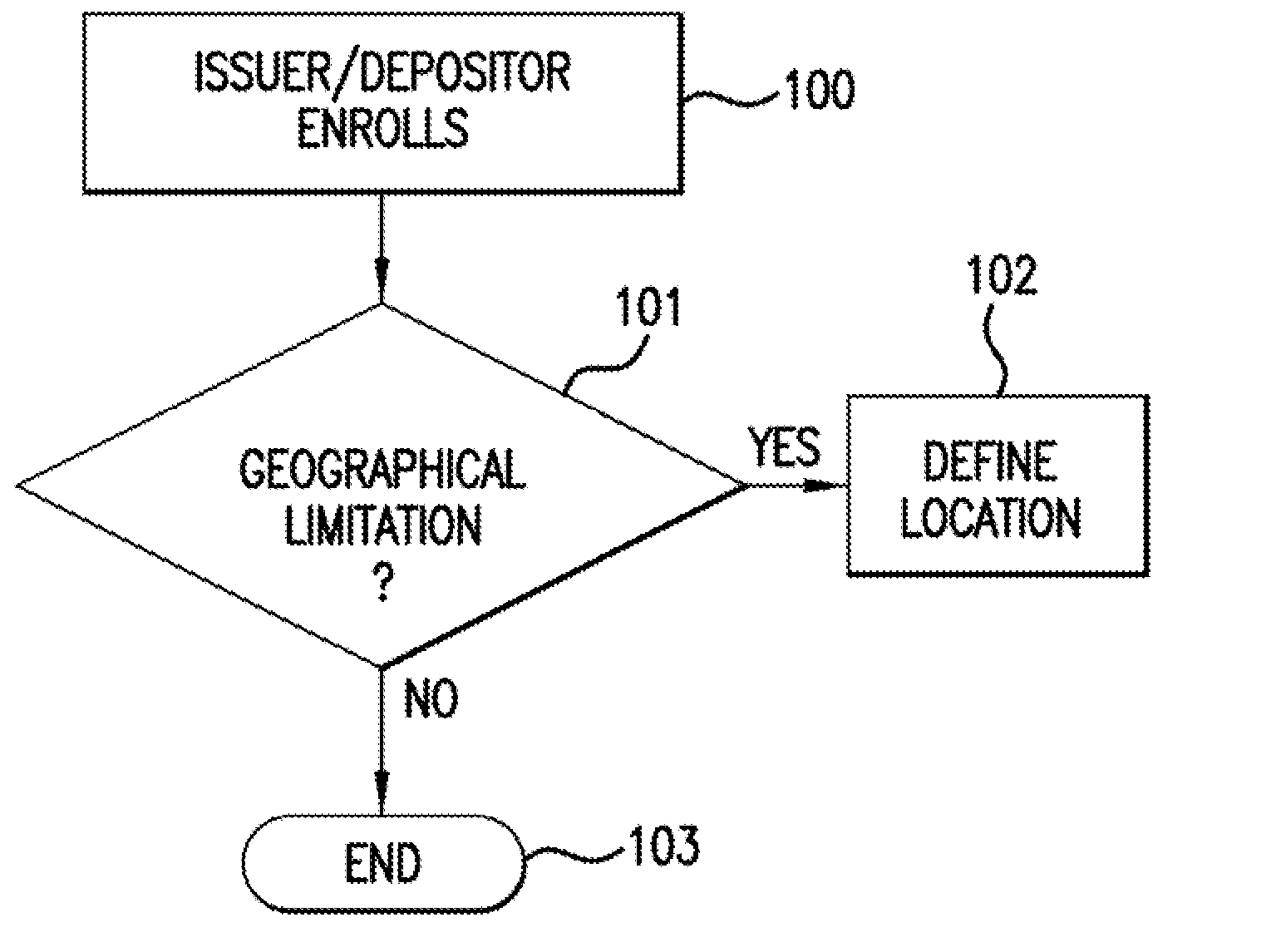

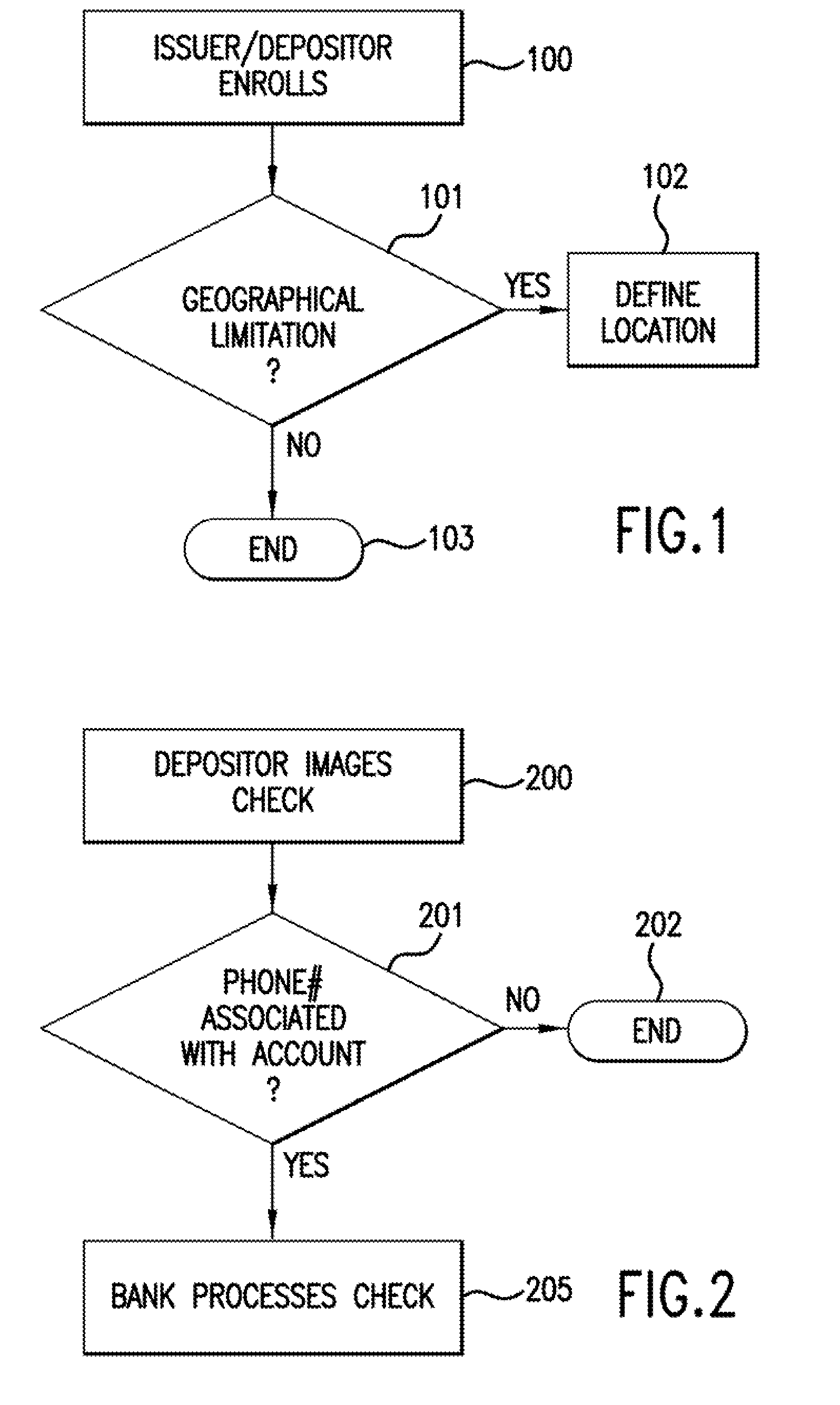

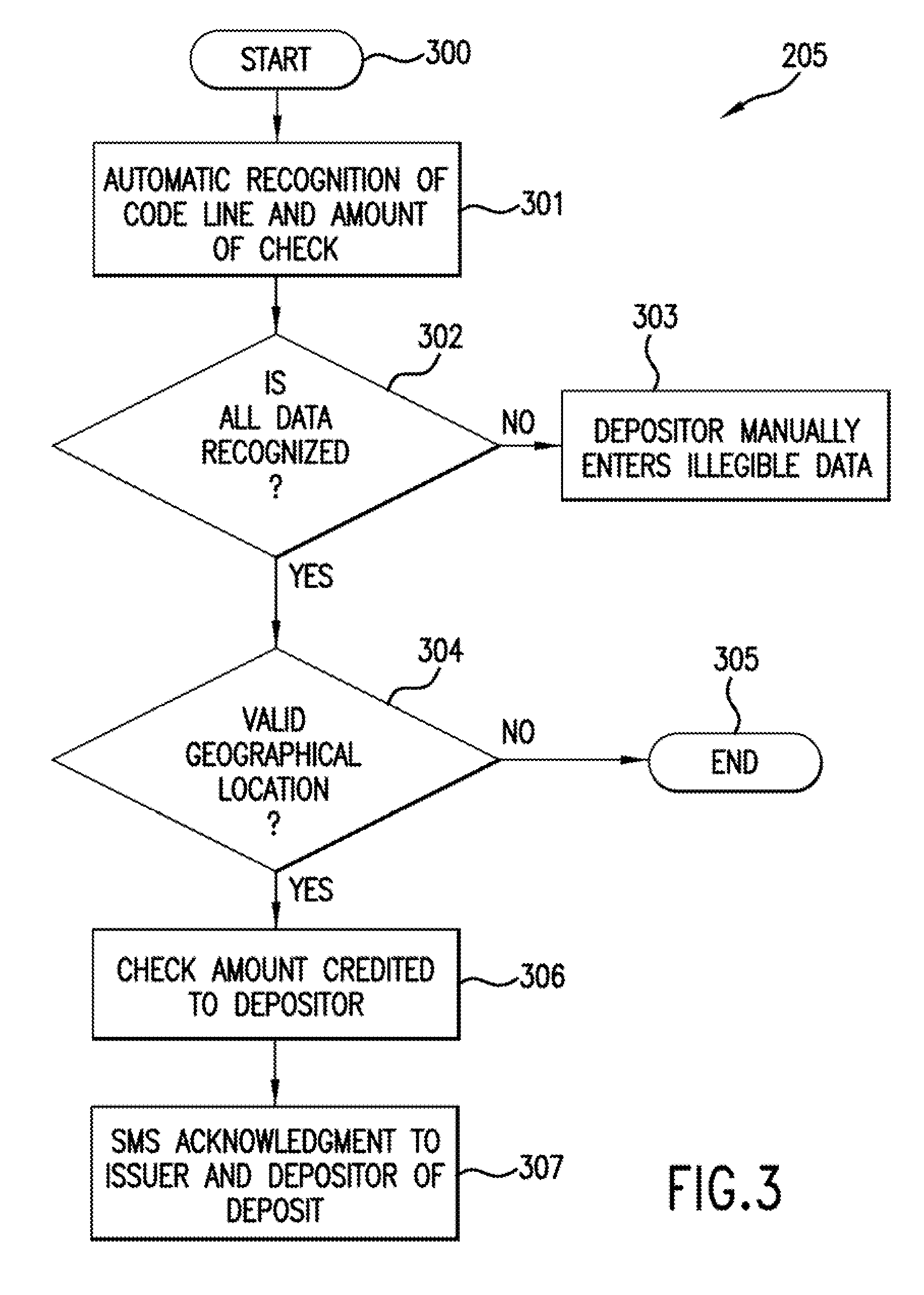

Method for remote check deposit

InactiveUS20100082470A1Without usingReduce operating costsFinancePayment architectureImaging qualityBank account

A method and system for depositing a negotiable instrument, such as a check, using a cellular phone camera. The customer images the check for deposit by taking a photograph of the check with his cellular phone camera and sends the photograph as a MMS to the customer's bank. The system enables validating image quality, automatically recognizing code line, confirming geographical location of the deposit and verifying a courtesy amount of the check so that the check is deposited into the customer's bank account remotely.

Owner:IBM CORP

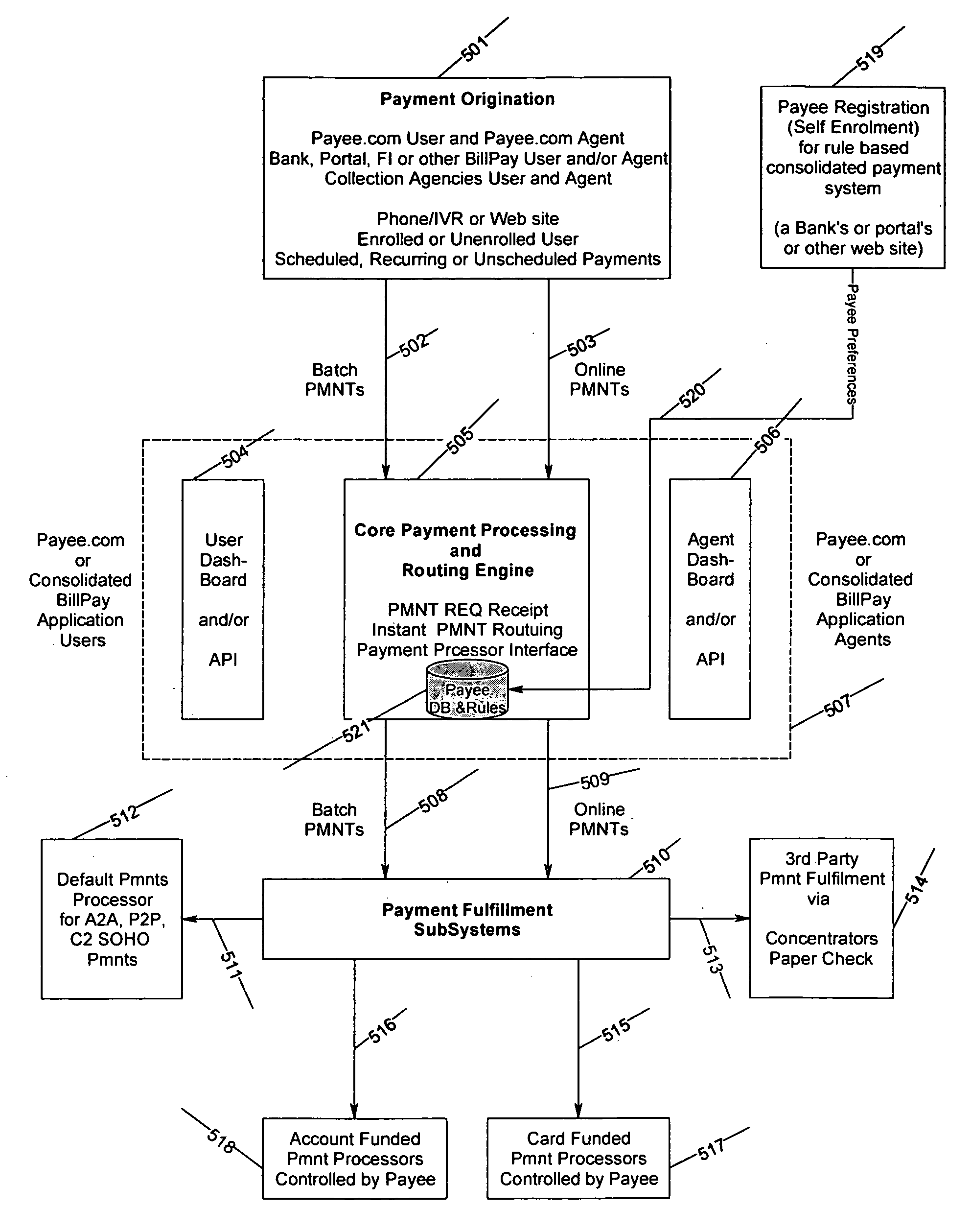

Electronic payment system for financial institutions and companies to receive online payments

InactiveUS20060206425A1Improve consumer experienceHigh speedFinanceProtocol authorisationPayment transactionPersonal account

The present invention provides an a electronic payment system for bank, financial institutions, portals and companies to receive payment from their customers for one or more payees. The electronic payment system allows payer (consumer or business) to use any funding method (bank account, credit / debit cards or any other business or personal account or method associated with one or more banks) accepted by the payee to initiate a payment and the payment transaction is routed to the appropriate payment processor based on payee's preferences. The electronic payment system also provides a instant payment delivery notification to the payer directly from the payee. The system also creates a unique payment tracking number which can be used by all parties associated with the transaction to track a payment's status and other attributes associated with the payment. The electronic payment system also provides a rule based payment management system for the payees to use for managing the processing and posting of the payments. The system also allows for payees to manage their payments received and post to various receivable systems based on rules defined. Additionally, the system allows payees to create rules for other aspects of payment processing. The system also allows for much simplified electronic bill delivery system which uses biller's existing infrastructure to create bill data for distribution to 3rd party consolidators.

Owner:PAYMENTUS CORP

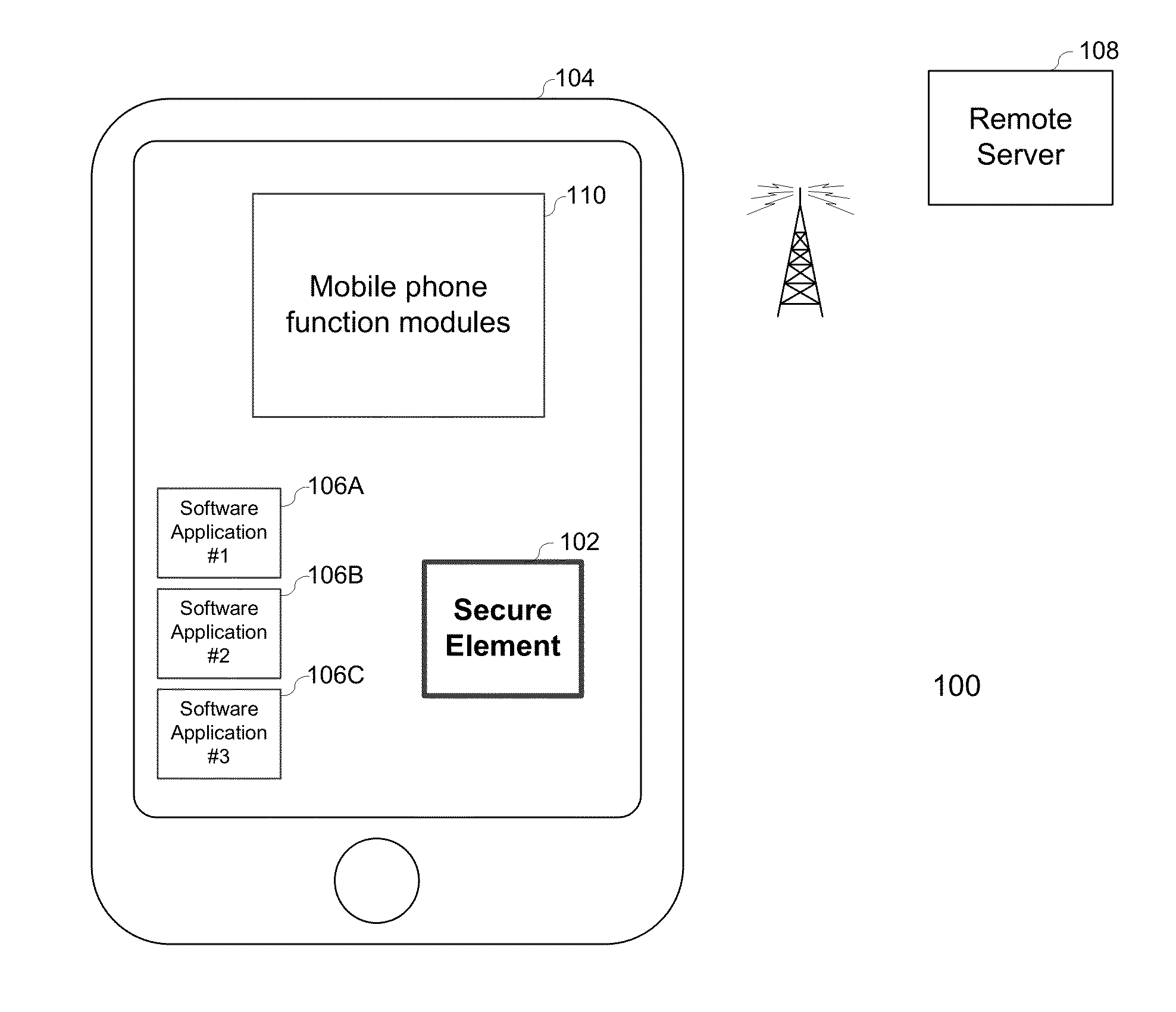

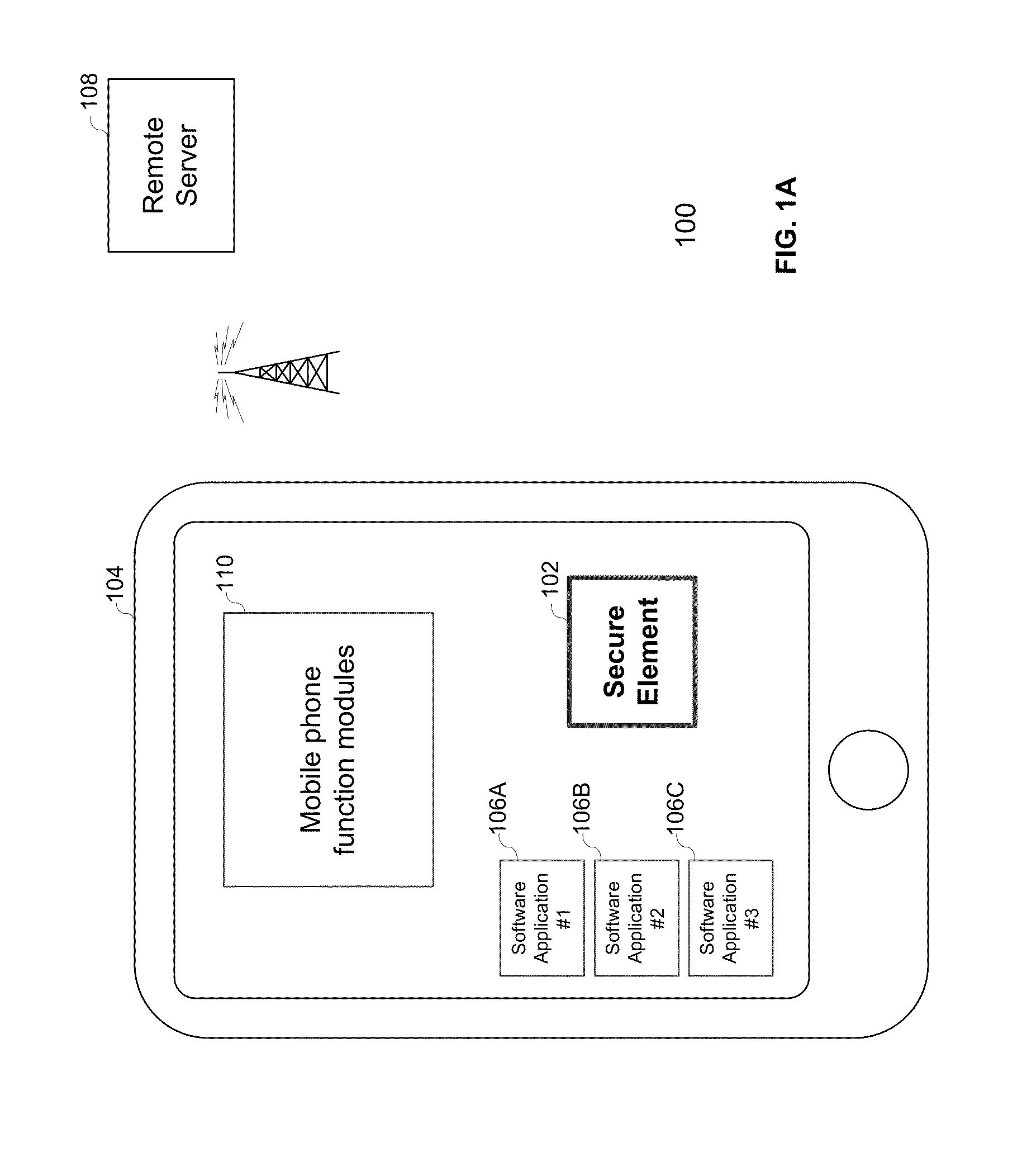

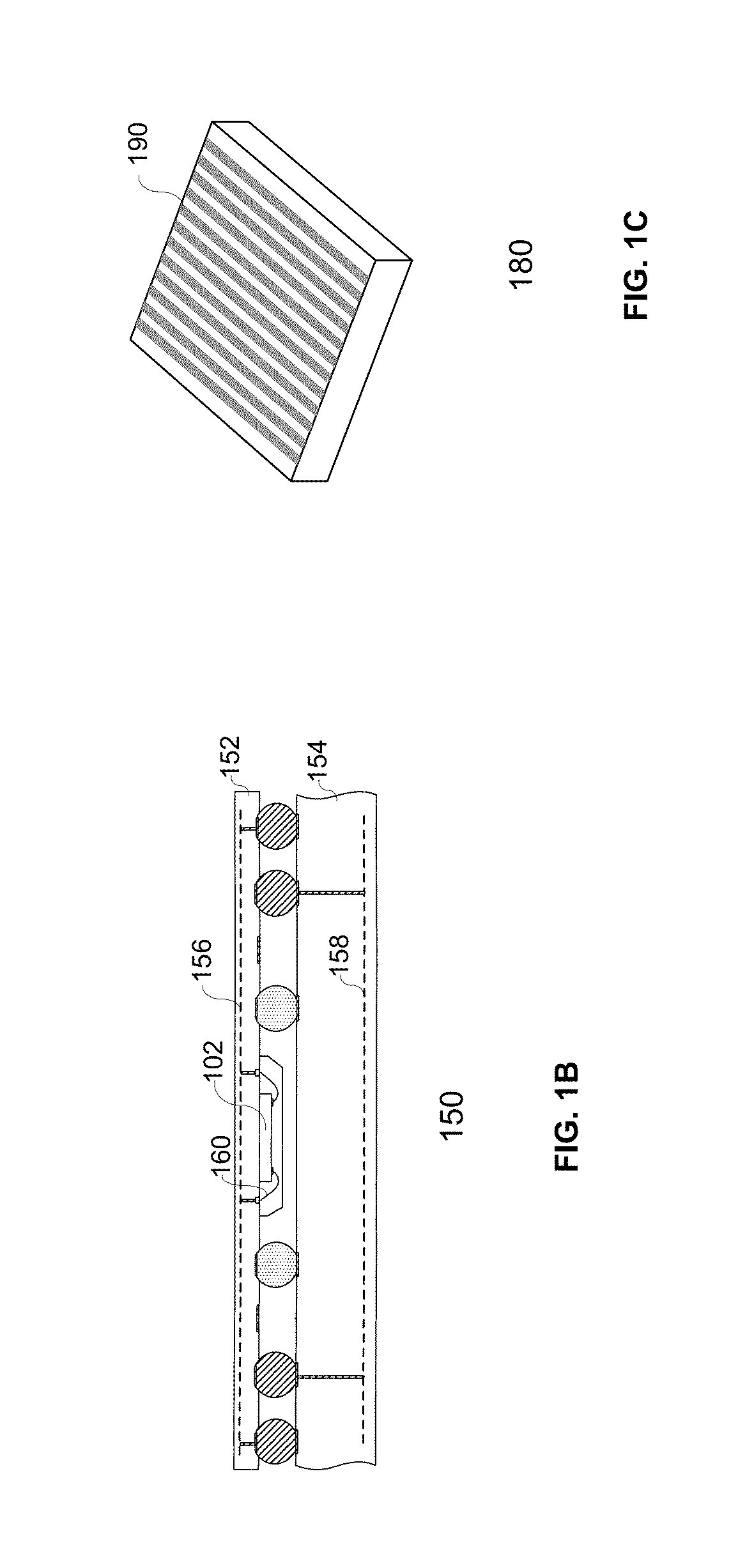

Embedded secure element for authentication, storage and transaction within a mobile terminal

ActiveUS20140013406A1Improve security levelImprove securityNear-field transmissionDigital data processing detailsEmbedded securityApplication software

Various embodiments of the present invention relate to incorporating an embedded secure element into a mobile device, and more particularly, to systems, devices and methods of incorporating the embedded secure element into a mobile device for identity authentication, data storage and processing in trusted transactions. These trusted transactions require a high security level to protect sensitive data or programs in bank account management, purchasing orders, contactless payment, passport verification, and many other high-security applications. The secure element will provide a root of trust such that that applications running on the mobile device are executed in a controlled and trusted environment. In addition to conventional password or encryption protection, alternative security features are introduced from both software and hardware levels based on the embedded secure element. Therefore, the security level of the mobile device is not only enhanced, but also may potentially exceed that of the conventional POS terminals.

Owner:MAXIM INTEGRATED PROD INC

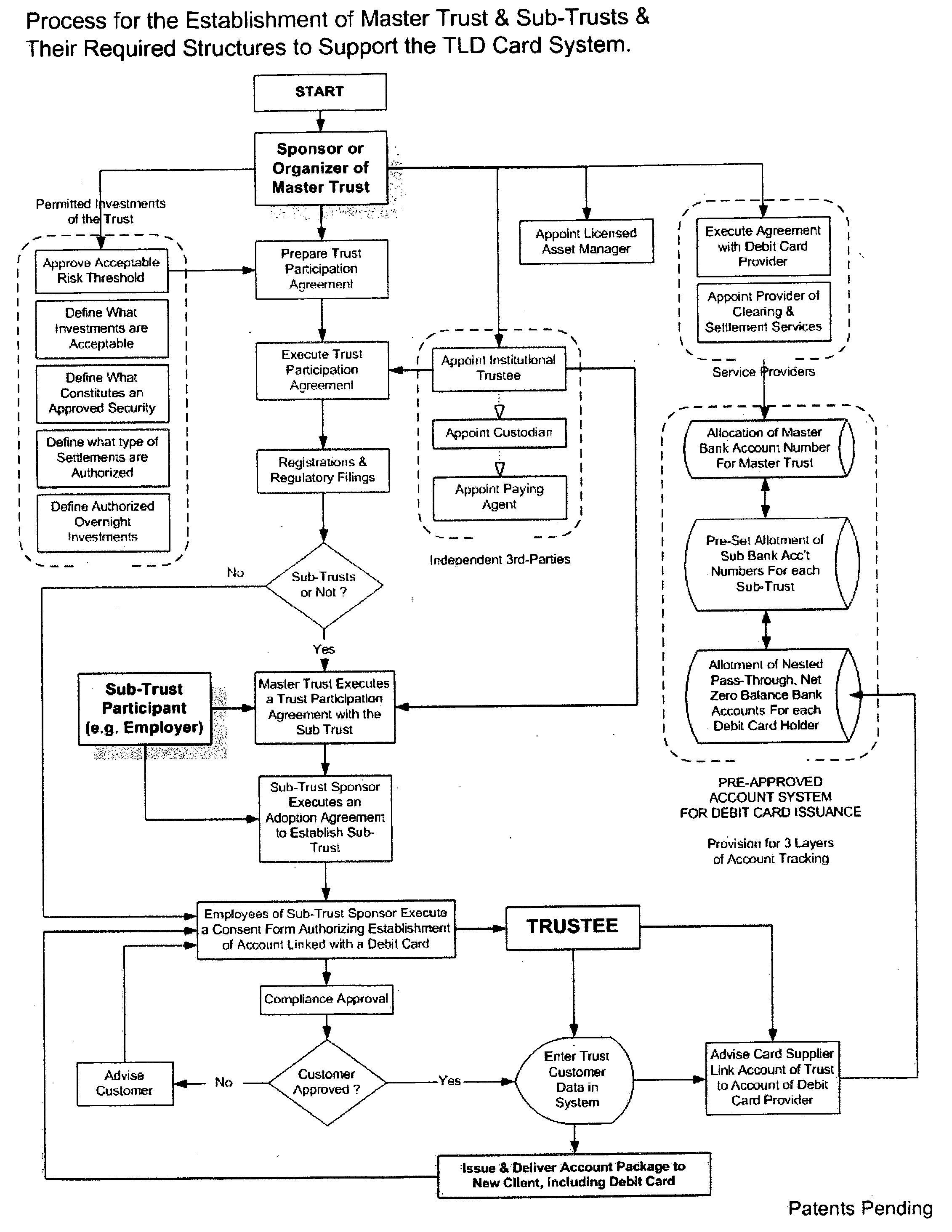

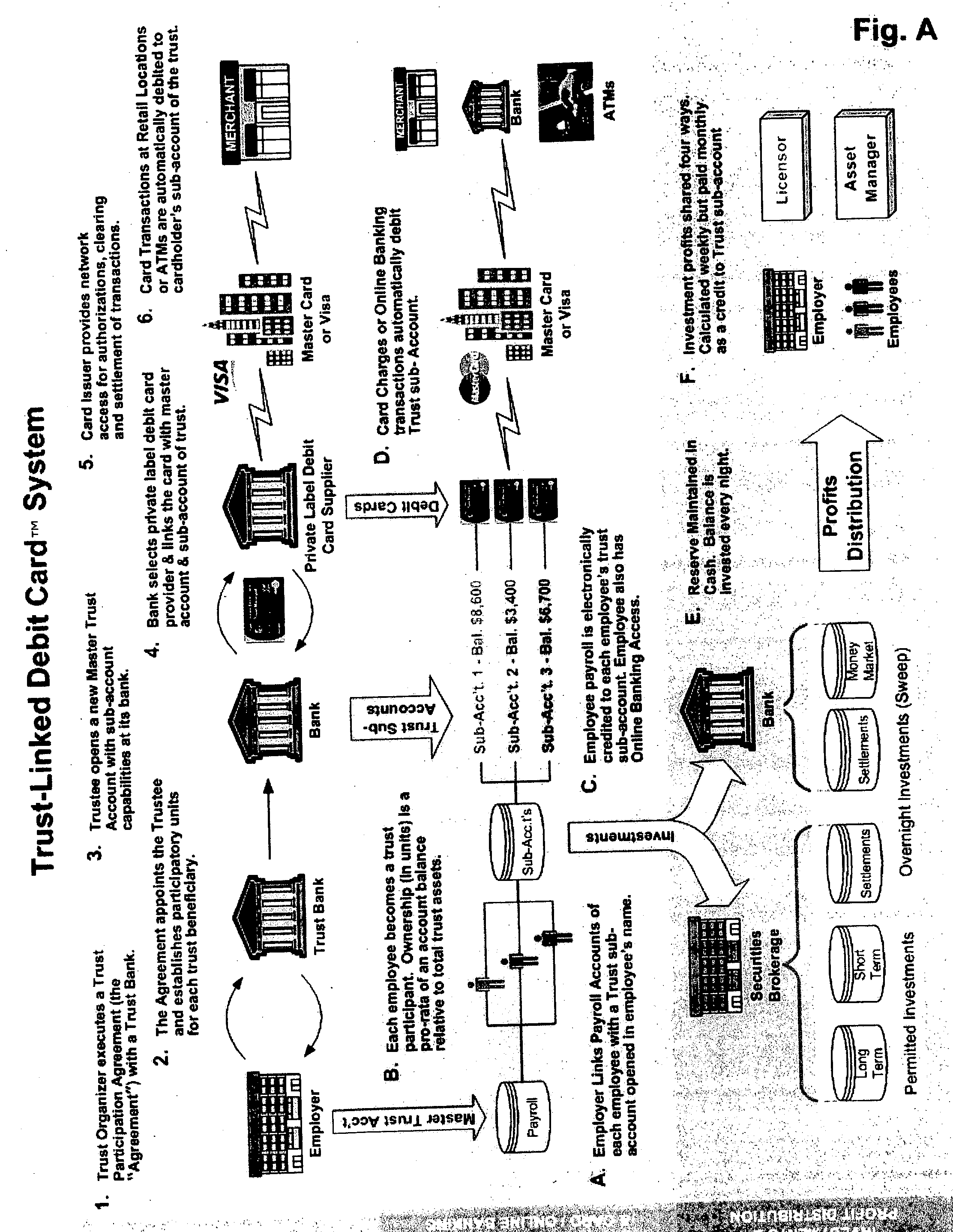

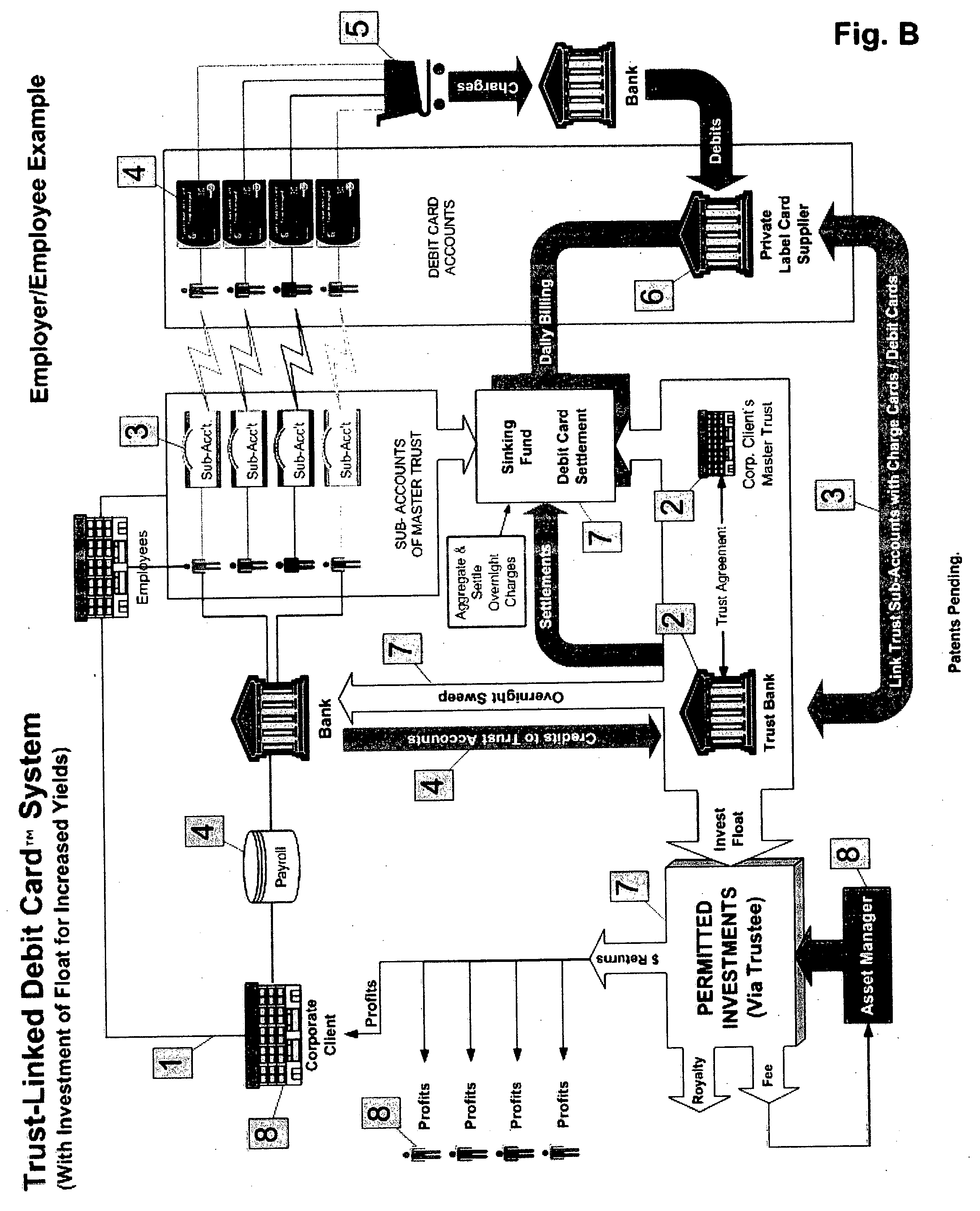

Trust-linked debit card technology

A revenue-producing debit card system and method for users who have bank accounts includes a trust account and plural debit cards. Each debit card is linked to a trust account that allows overnight balances to be invested at a profit for the benefit of the account holder. The system also includes a link between a bank account of a user, a debit card of the user, and the trust account, so that the debit card is linked to a bank account that is a pass-through, net zero balance bank account. The trust account includes a trust sub-account of the user, and the cash balance required to settle card transactions of the user is each time transferred from the trust sub-account of the user. The bank account of the system is used only to book a simultaneous debit and credit for the bank account each time the debit card is used by the user at a remote merchant location, and to report card activity usage. The method also creates a legal structure (e.g. a trust) in which the debit card user is a beneficiary and the user's ownership interest in the trust is evidenced by issuance and delivery of a floating trust-participation receipt. The user's beneficial interest in the trust fluctuates as debits and credits are posted to the user's bank account. The user's percentage ownership in the trust is the pro-rata of his account balance at any point in time relative to the total amount of money in the trust.

Owner:DE LA MOTTE ALAIN L

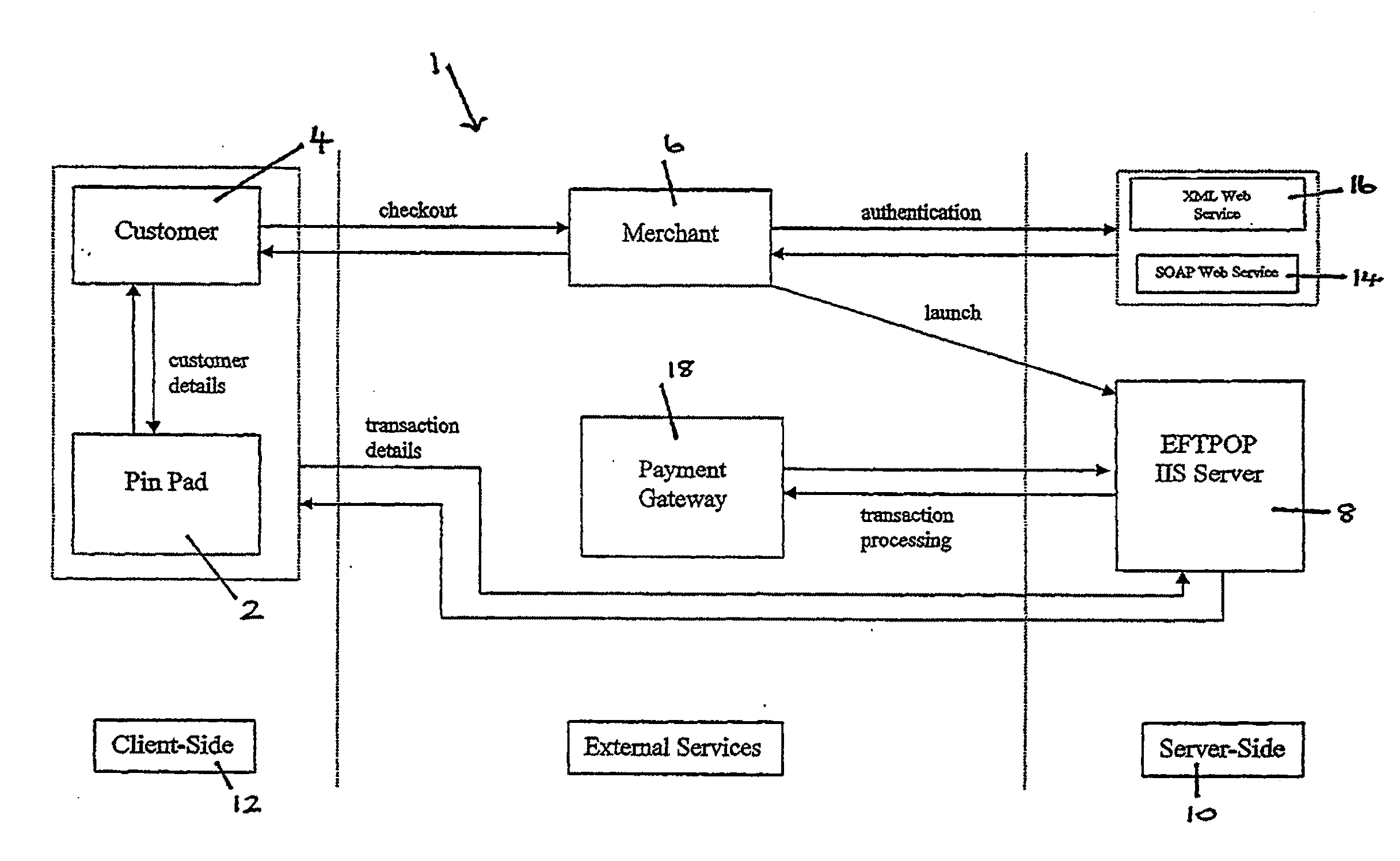

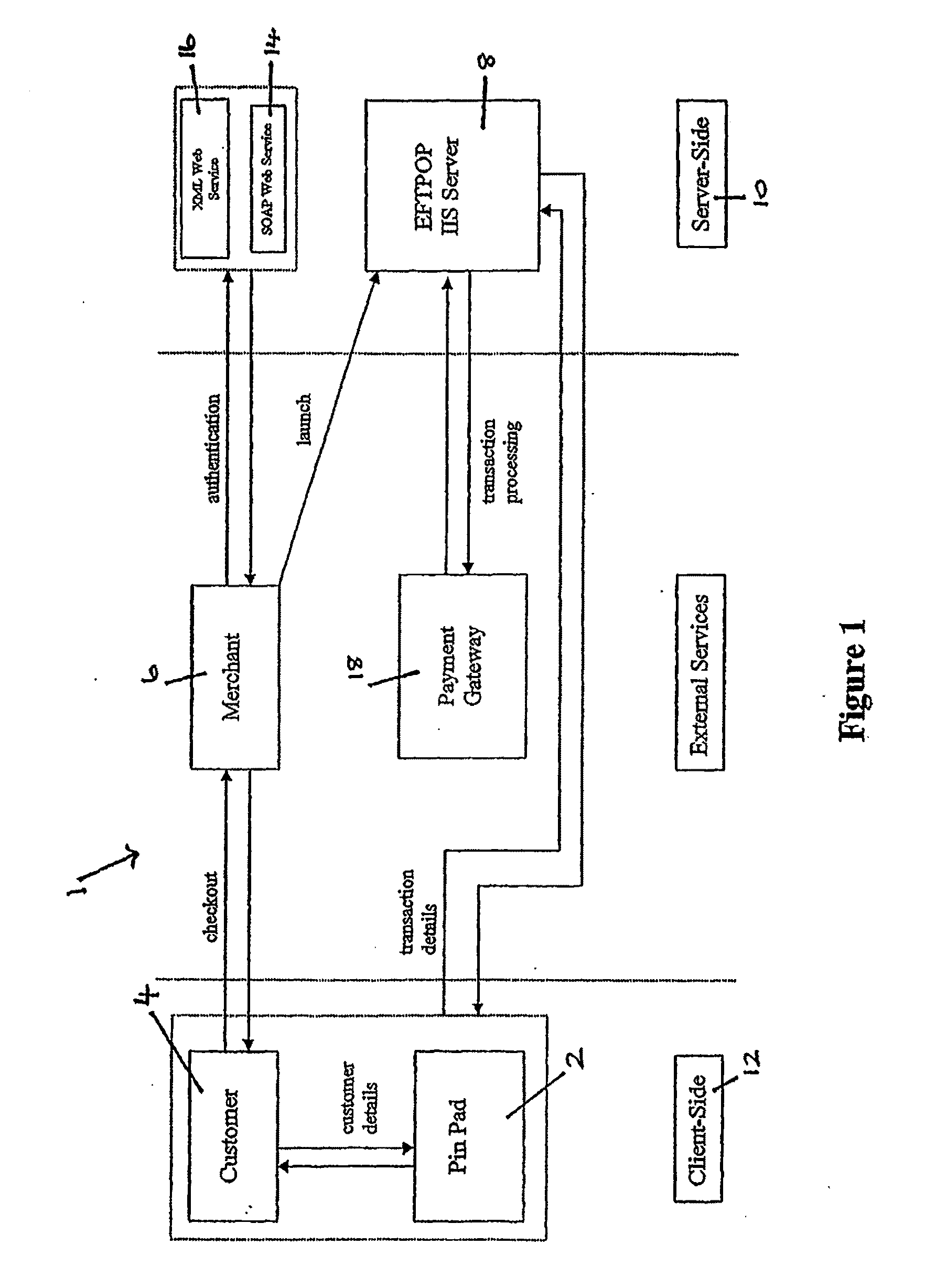

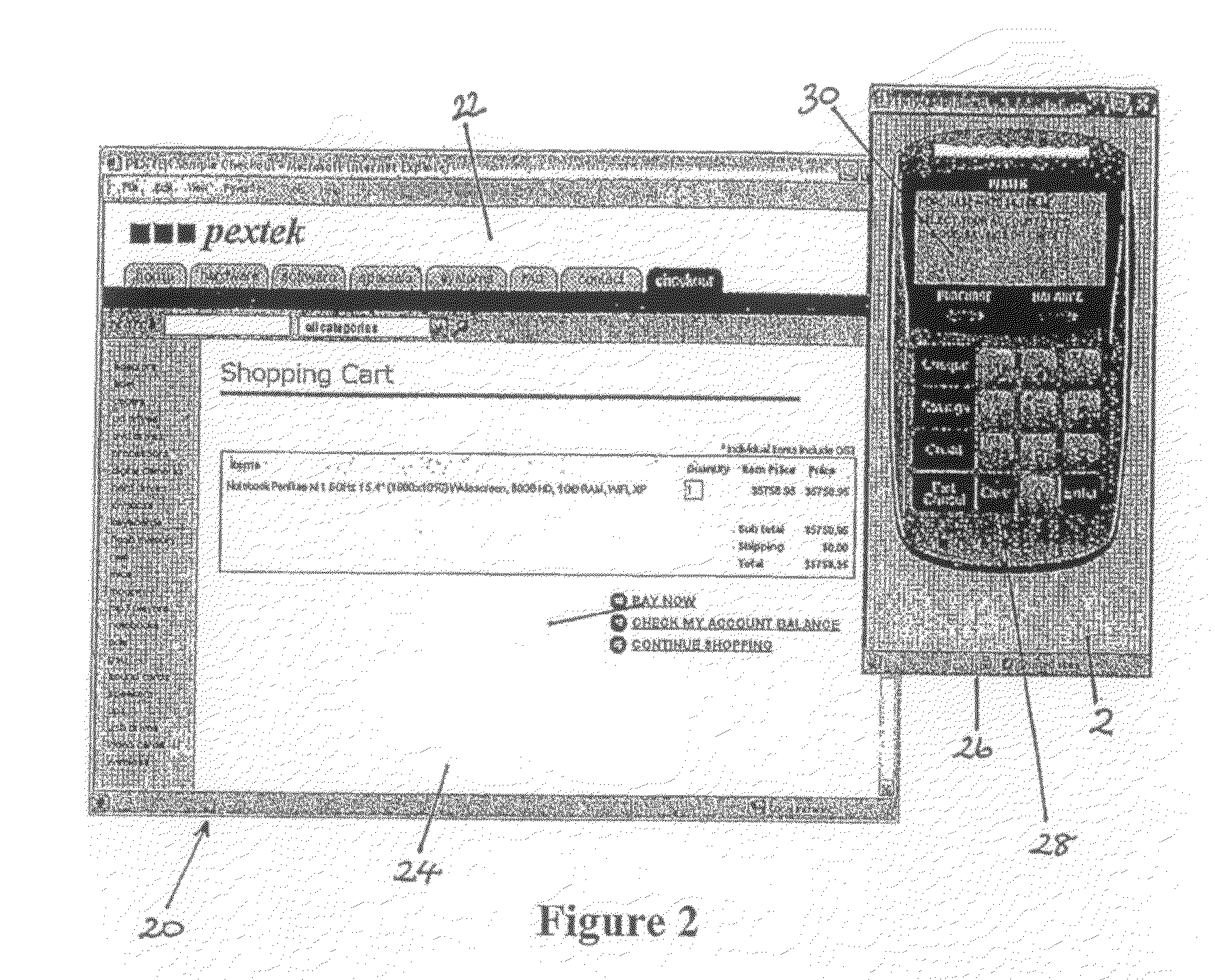

Online Payment System for Merchants

InactiveUS20090307133A1Improve vulnerabilityReduce the amount requiredFinancePayment circuitsBank accountInternet access

A payment system that utilises the Internet to gain access to an Internet banking system enabling a user to purchase merchandise bought through an online merchant or merchant who has Internet access in their store is disclosed. The payment system may also be utilised to provide a means for a user to retrieve and view balances and account transaction information for their bank accounts and to transfer funds between accounts. The system uses a “virtual pin-pad” which provides a web-based, stand-alone method of payment that is independent of banks and capable of performing real-time currency conversions.

Owner:EFTOL INT LTD

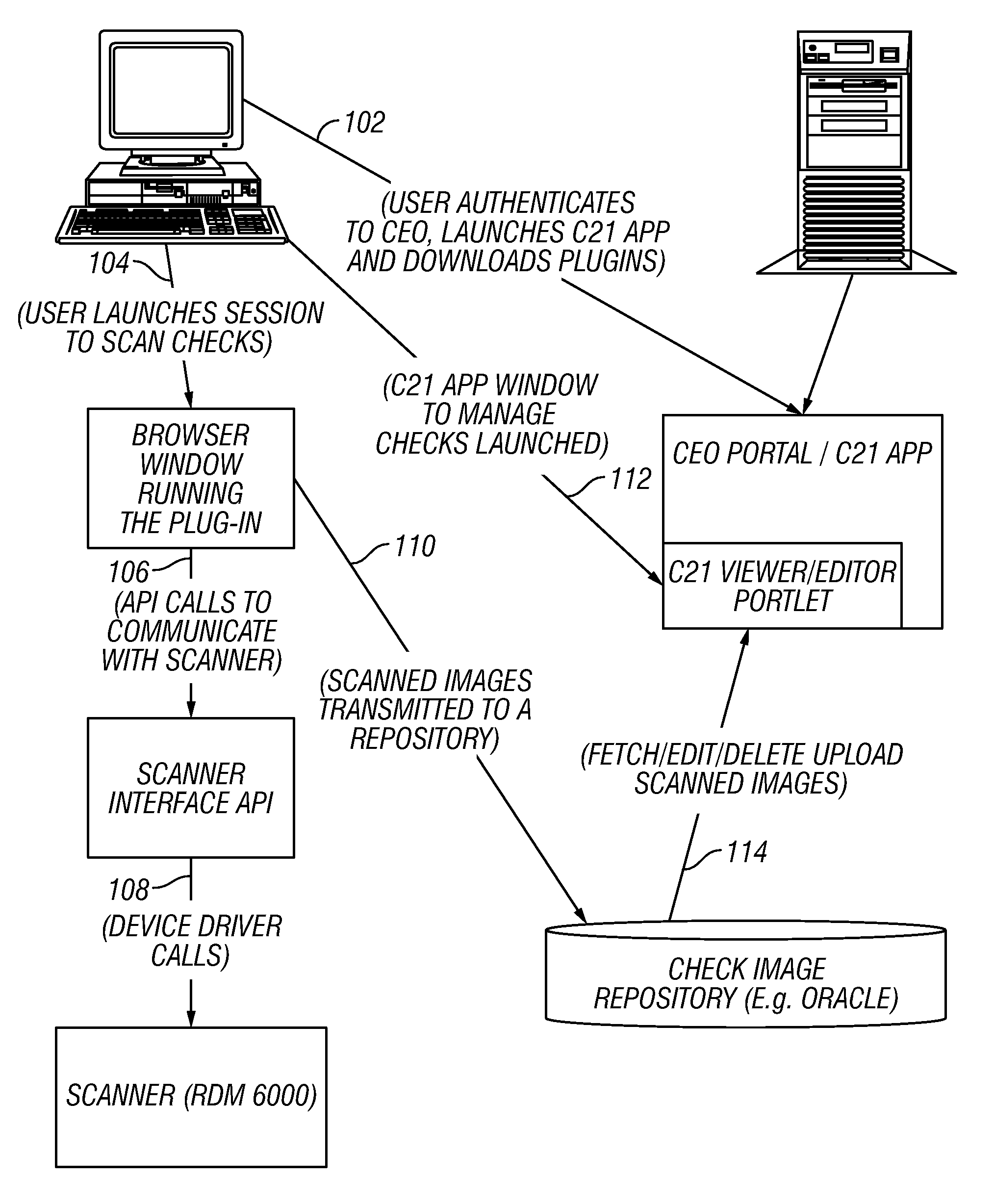

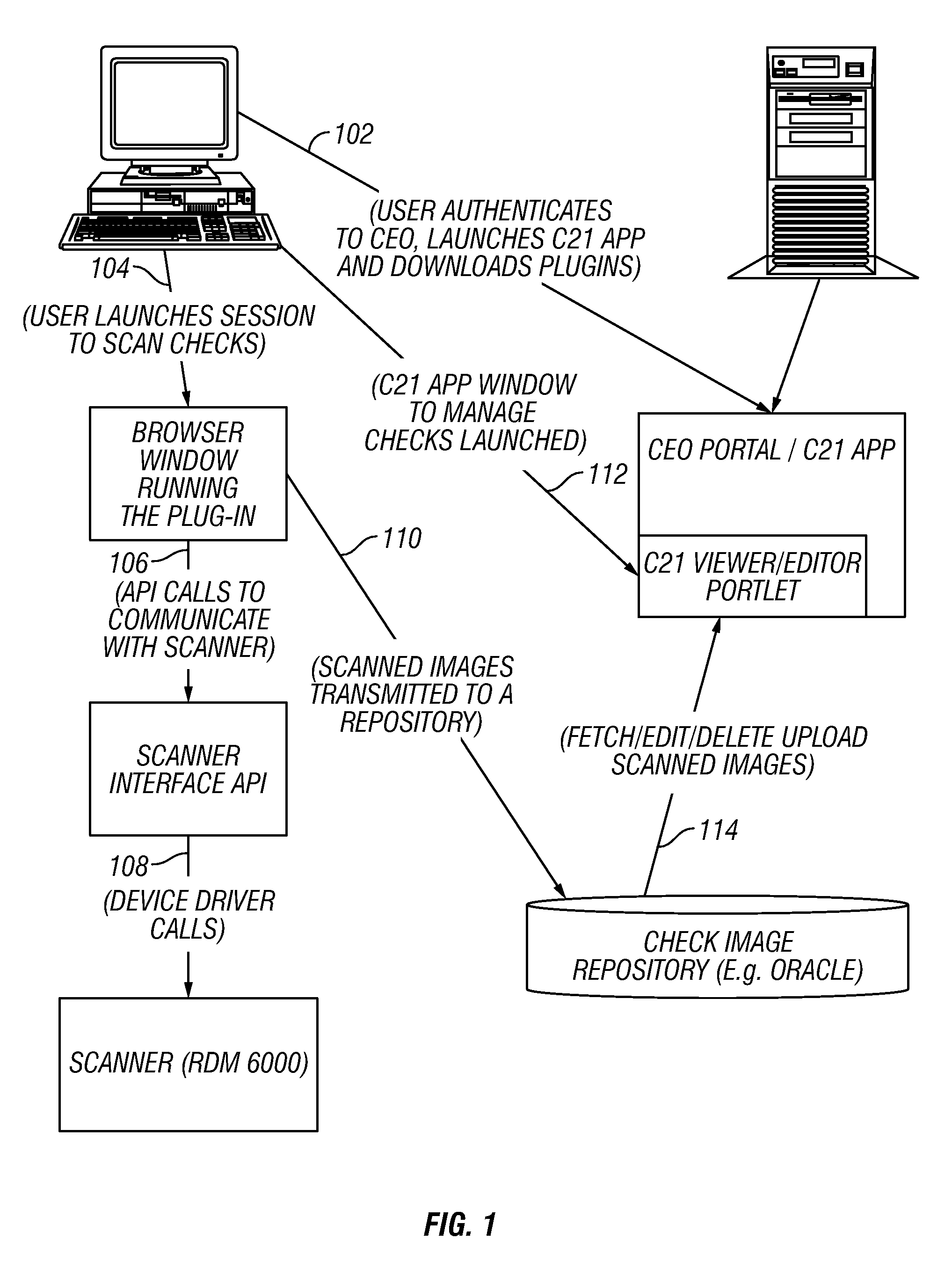

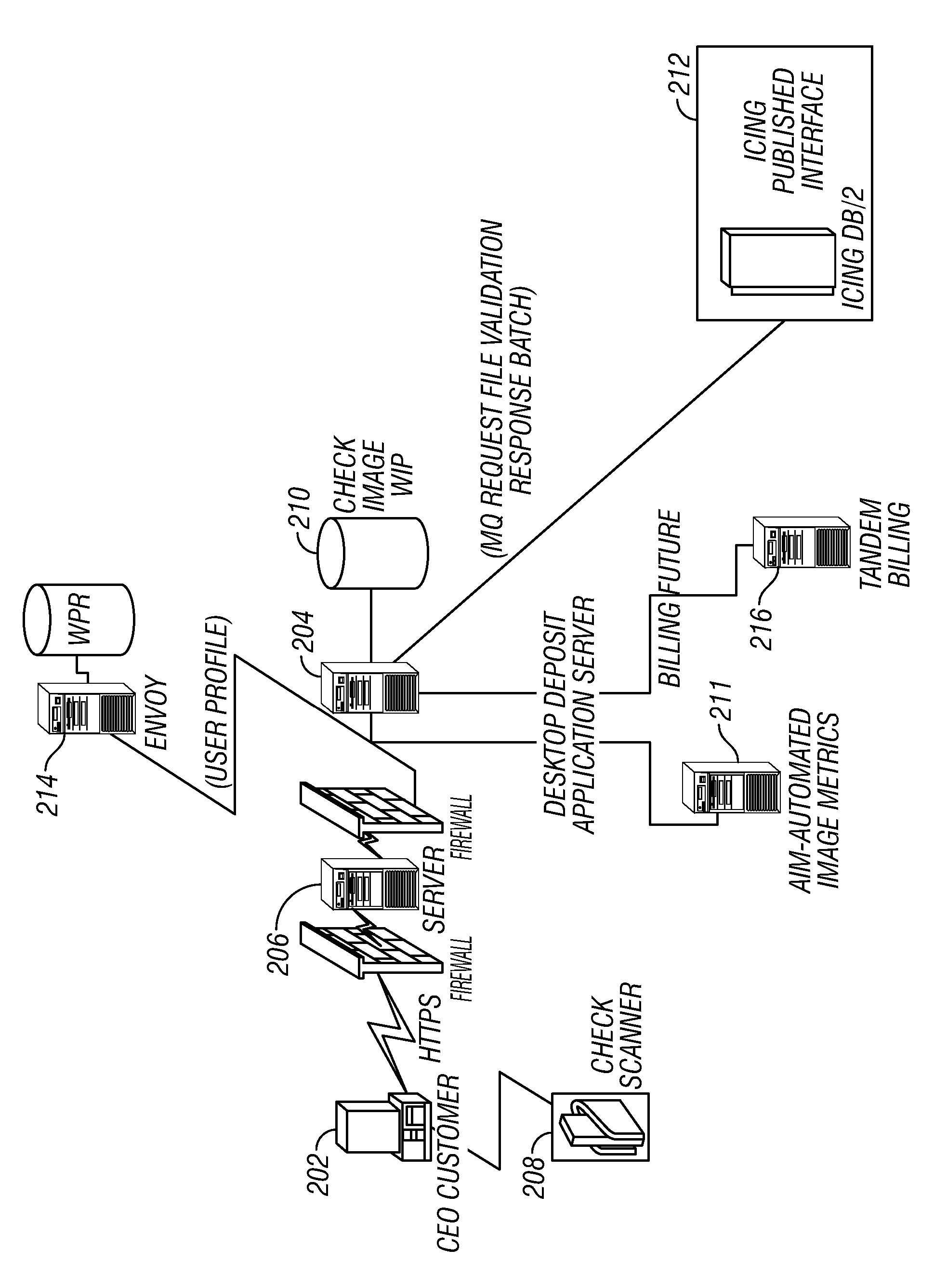

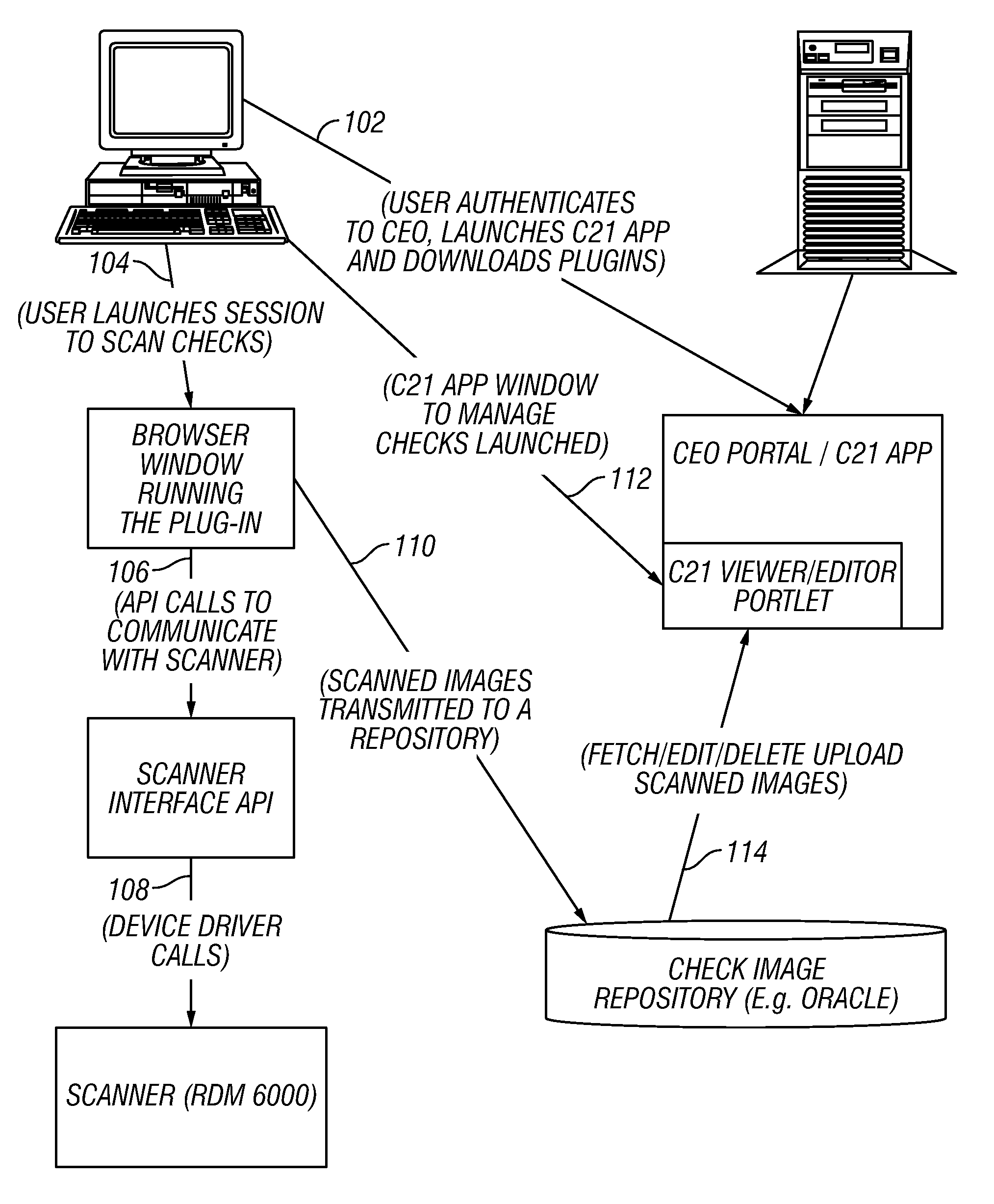

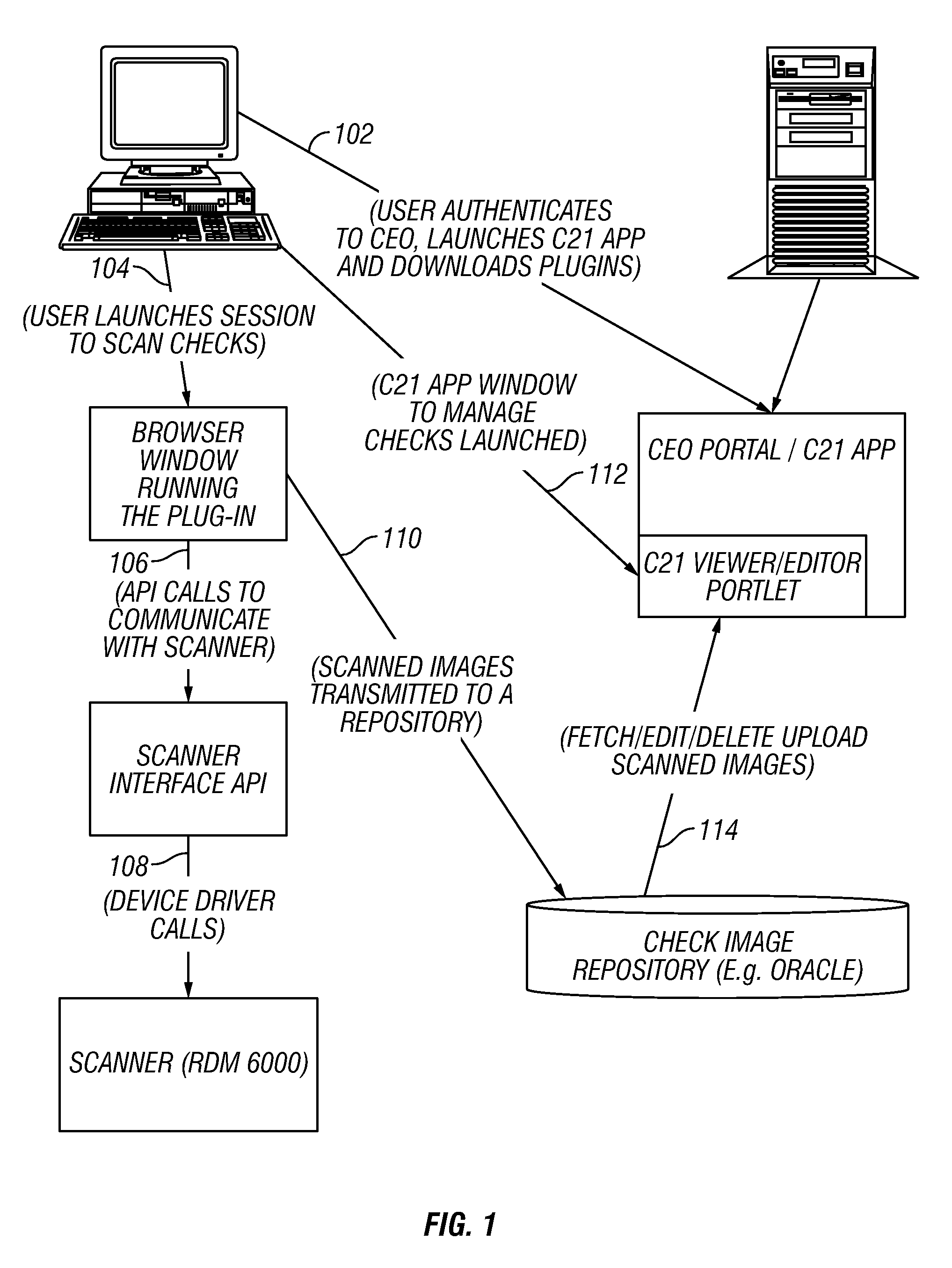

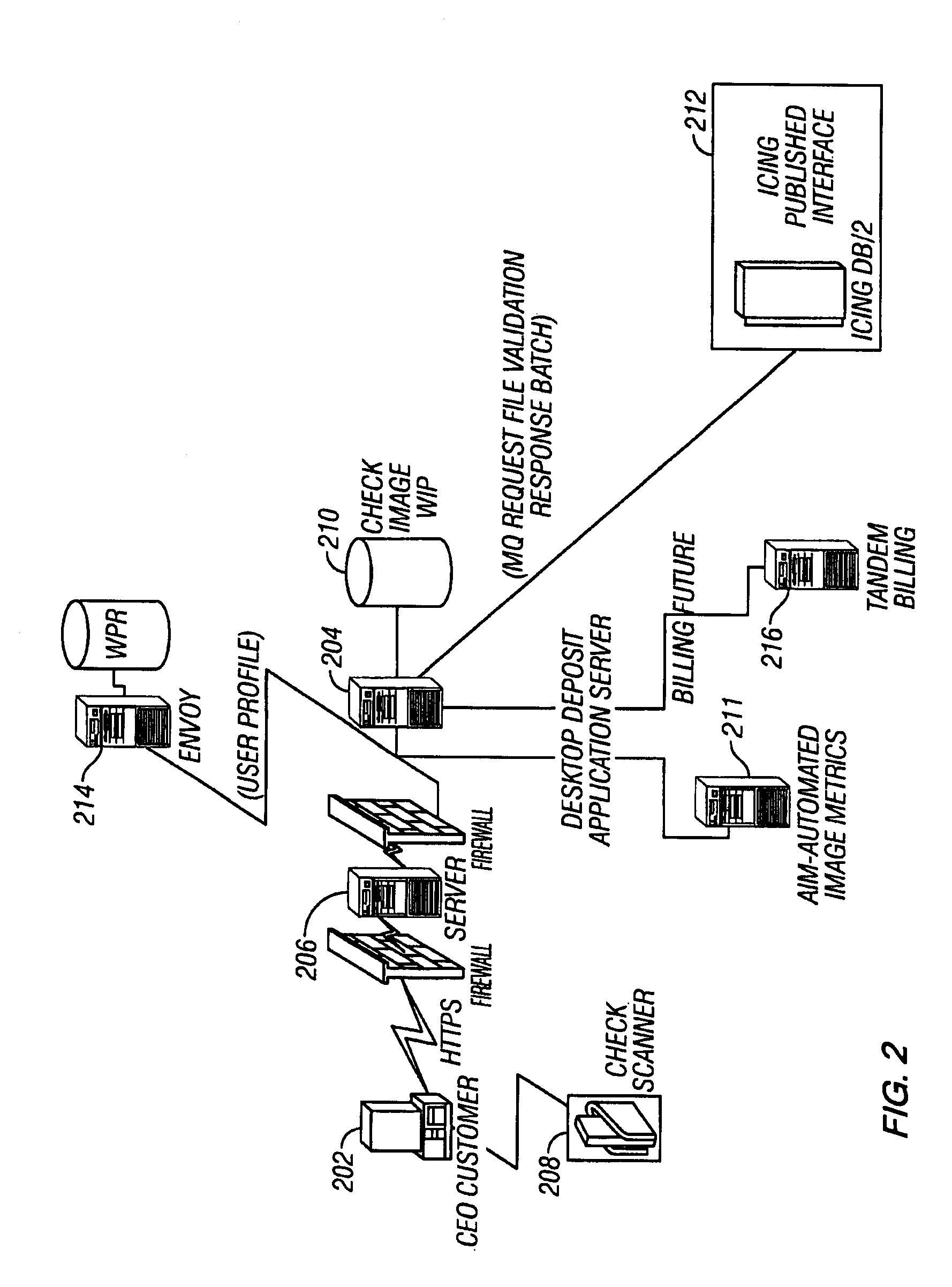

Method and apparatus for accepting check deposits via the Internet using browser-based technology

A browser plug-in to drive a device for securely transmitting documents in real-time over the Internet into an enterprise's computing environment is provided. Leveraging the Check Clearing for the 21st Century Act, a system and method for providing a browser plug-in that allows a bank customer to scan checks using a personal computer and deposit the checks via the browser to a bank account is provided.

Owner:WELLS FARGO BANK NA

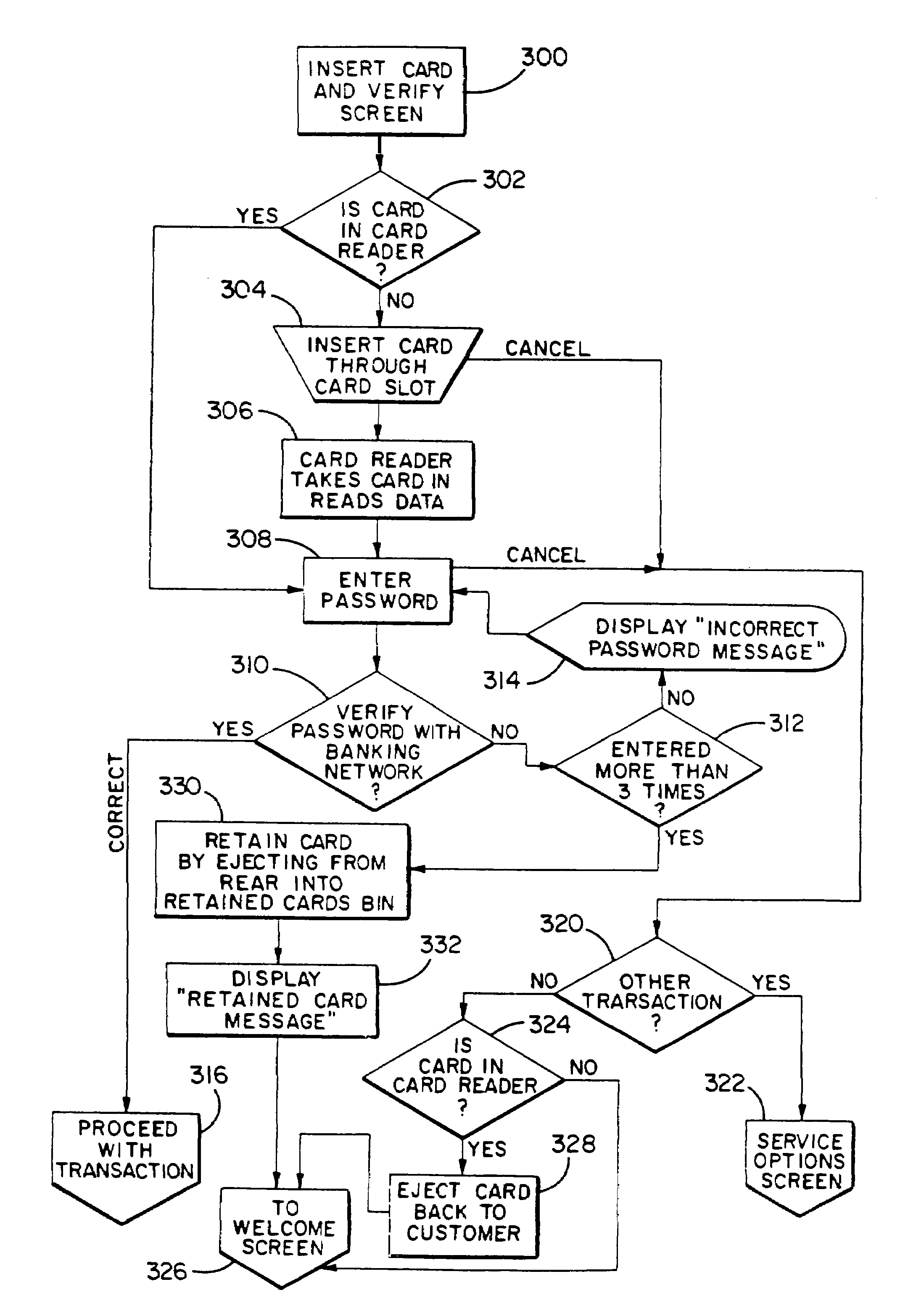

Automated document cashing system

InactiveUS7653600B2Magnification factor would decreaseAvoid zoom overshootComplete banking machinesFinanceCredit cardBank teller

An automated document cashing system is provided with an automated machine that cashes monetary transaction documents such as checks, money orders, and that makes deposit entries into the bank account of the user after validation of the user and monetary transaction document, without the aid of a bank teller. Validation of the identity of the user is performed with the use of a card associated with intelligence that identifies the user. A biometric device also may be used in identifying the validity of the user. Validation of the document involves one or more of: validating the presence of a signature; validating the amount of the monetary transaction document including a manual entry of the amount by the user; validating CAR against the LAR; and validating the banking system parameters and rules for the customer and / or the transaction. To assist in the automatic analysis of data on monetary transactional documents or on remittance documents, the user is prompted to provide a bounding box about the data. An image touch screen may be touched by the user to locate the bounding box and the user may magnify the data to fill the boundary box to exclude other data from this analysis. After document and person validation, the system will dispense money or transfer monies to a savings account, a checking account, a smart card, or the like. The system will also write money orders or wire transfer money. By supplying monies in the form of cash, credit card authorization, smart card balance, or the like to the machine, the user can pay bills such as a utility bill through the system or purchase items dispensed by the system.

Owner:UTILX CORP +2

Method and apparatus for accepting check deposits via the internet using browser-based technology

A browser plug-in to drive a device for securely transmitting documents in real-time over the Internet into an enterprise's computing environment is provided. Leveraging the Check Clearing for the 21st Century Act, a system and method for providing a browser plug-in that allows a bank customer to scan checks using a personal computer and deposit the checks via the browser to a bank account is provided.

Owner:WELLS FARGO BANK NA

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com