Patents

Literature

69 results about "Money order" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

A money order is a payment order for a pre-specified amount of money. As it is required that the funds be prepaid for the amount shown on it, it is a more trusted method of payment than a check. The money order system was established by a private firm in Great Britain in 1792 and was expensive and not very successful. Around 1836 it was sold to another private firm which lowered the fees, significantly increasing the popularity and usage of the system. The Post Office noted the success and profitability, and it took over the system in 1838. Fees were further reduced and usage increased further, making the money order system reasonably profitable. The only draw-back was the need to send an advance to the paying post office before payment could be tendered to the recipient of the order. This drawback was likely the primary incentive for establishment of the Postal Order System on 1 January 1881.

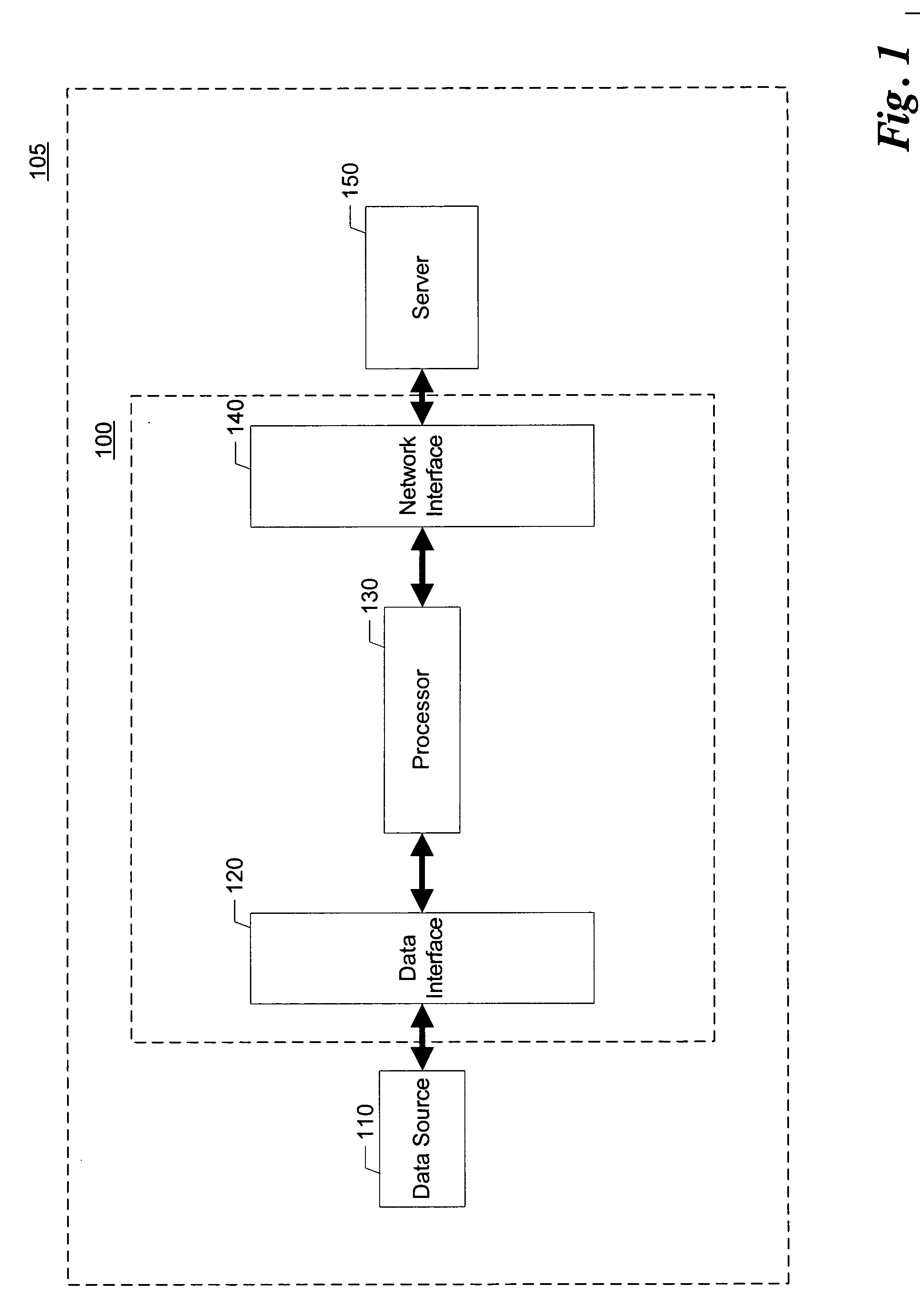

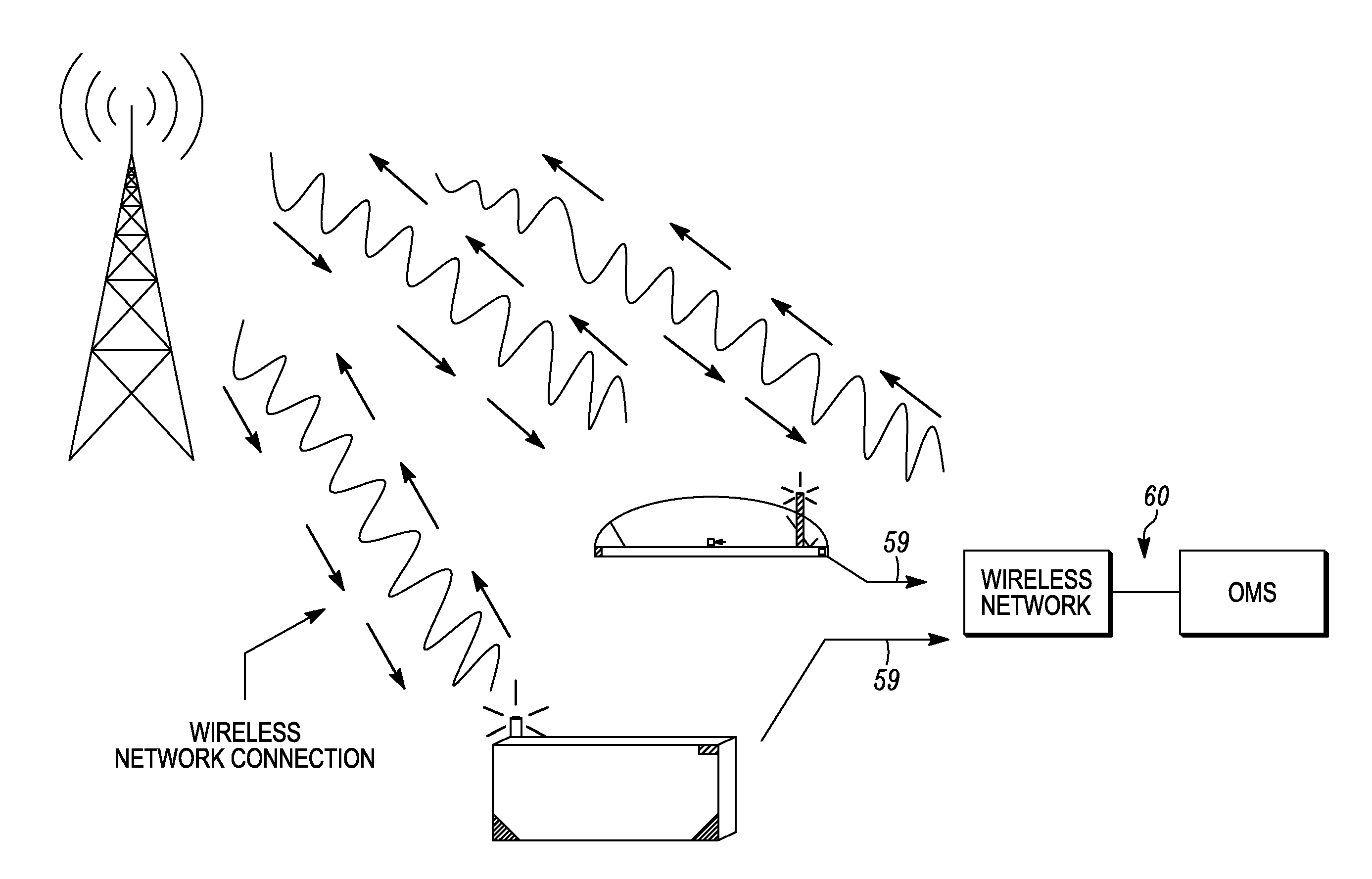

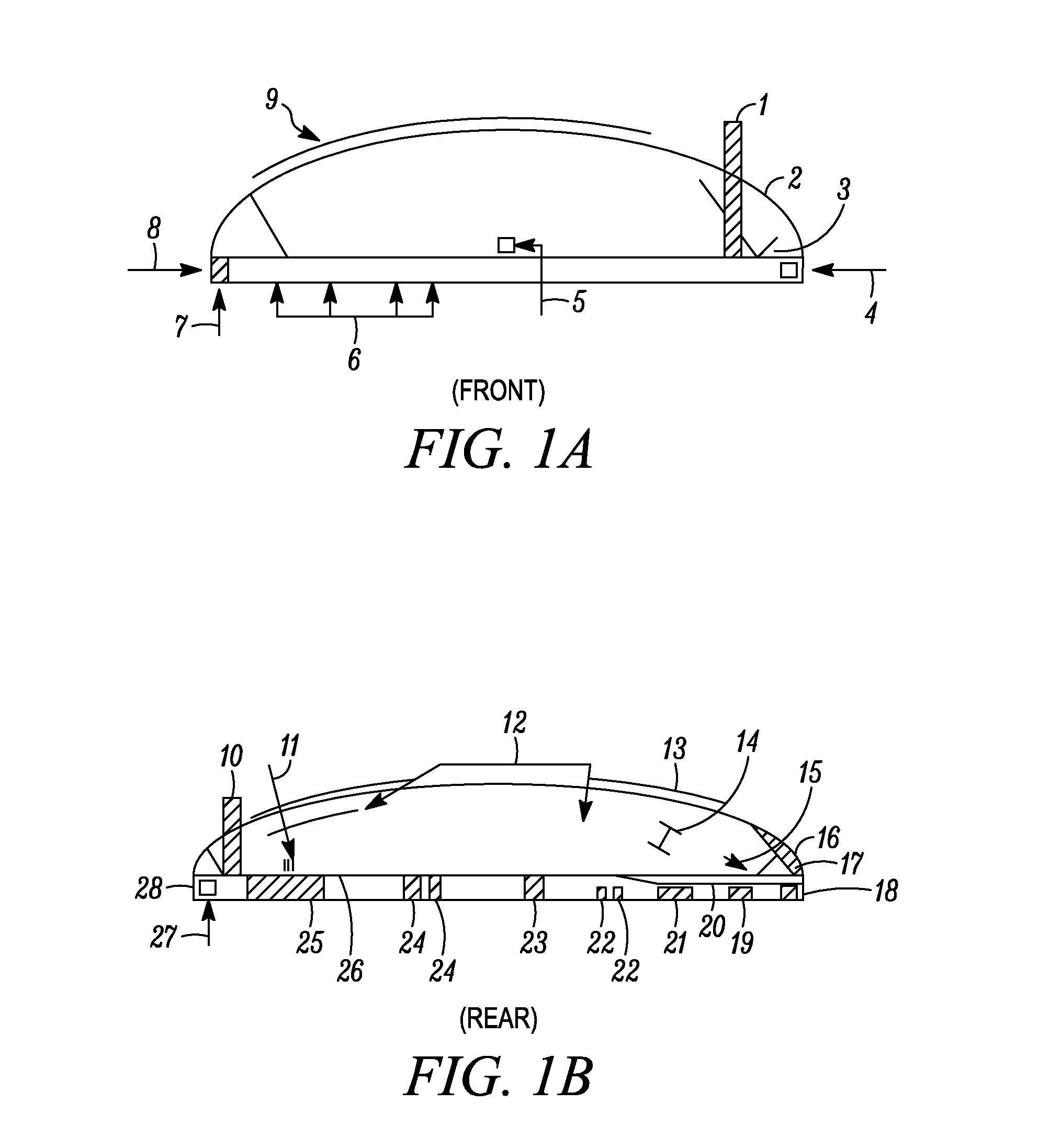

Wireless electronic check deposit scanning and cashing machine with web-based online account cash management computer application system

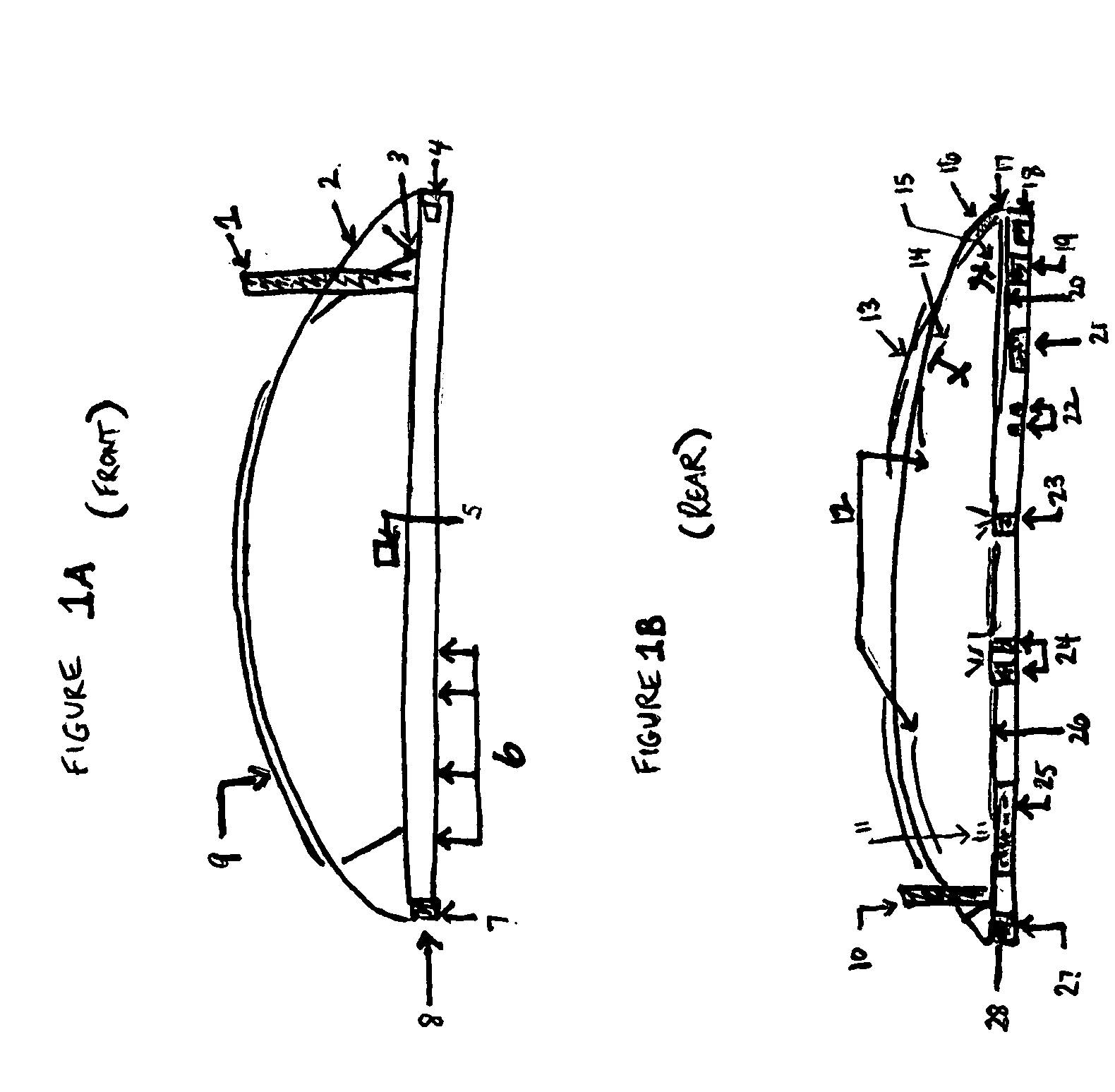

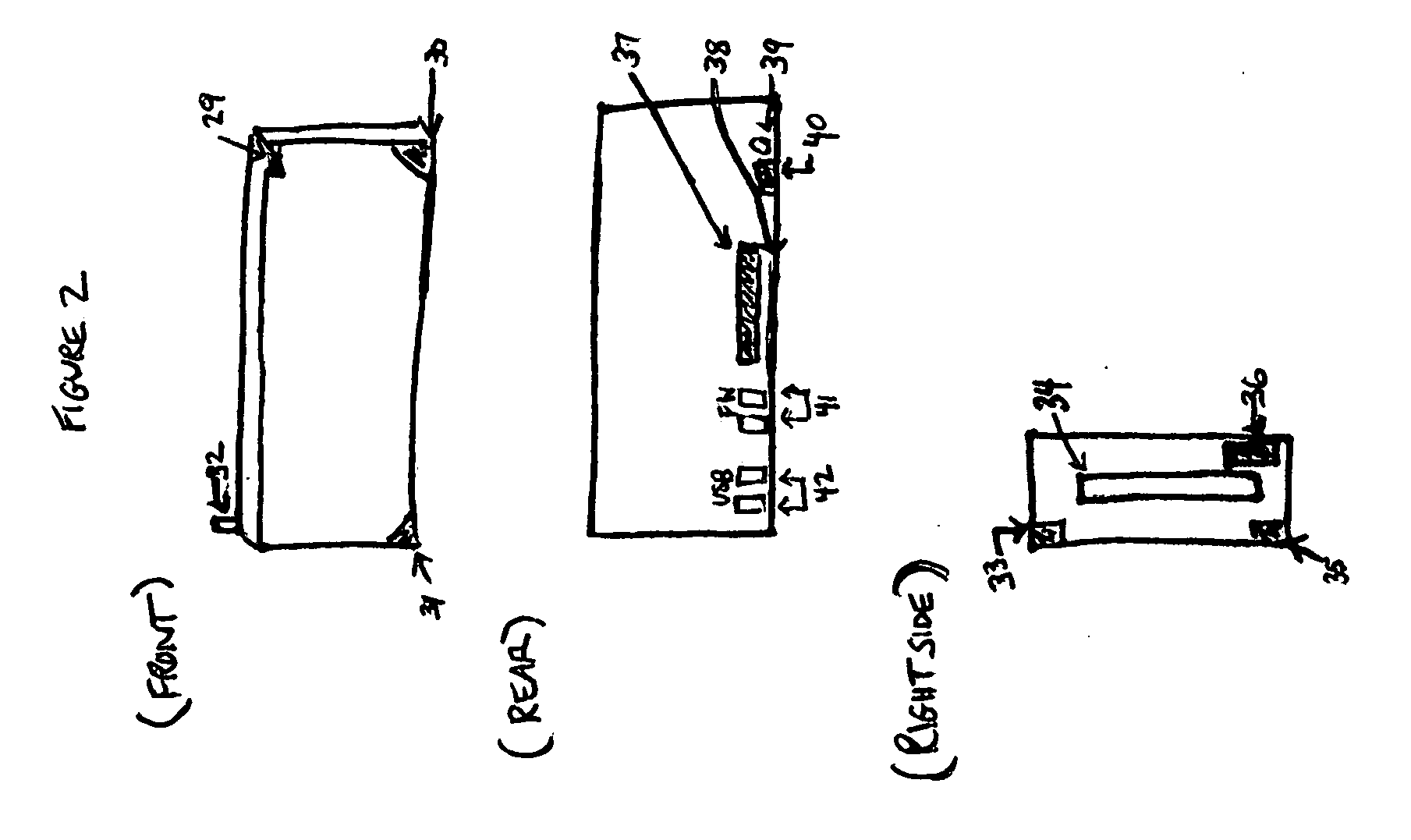

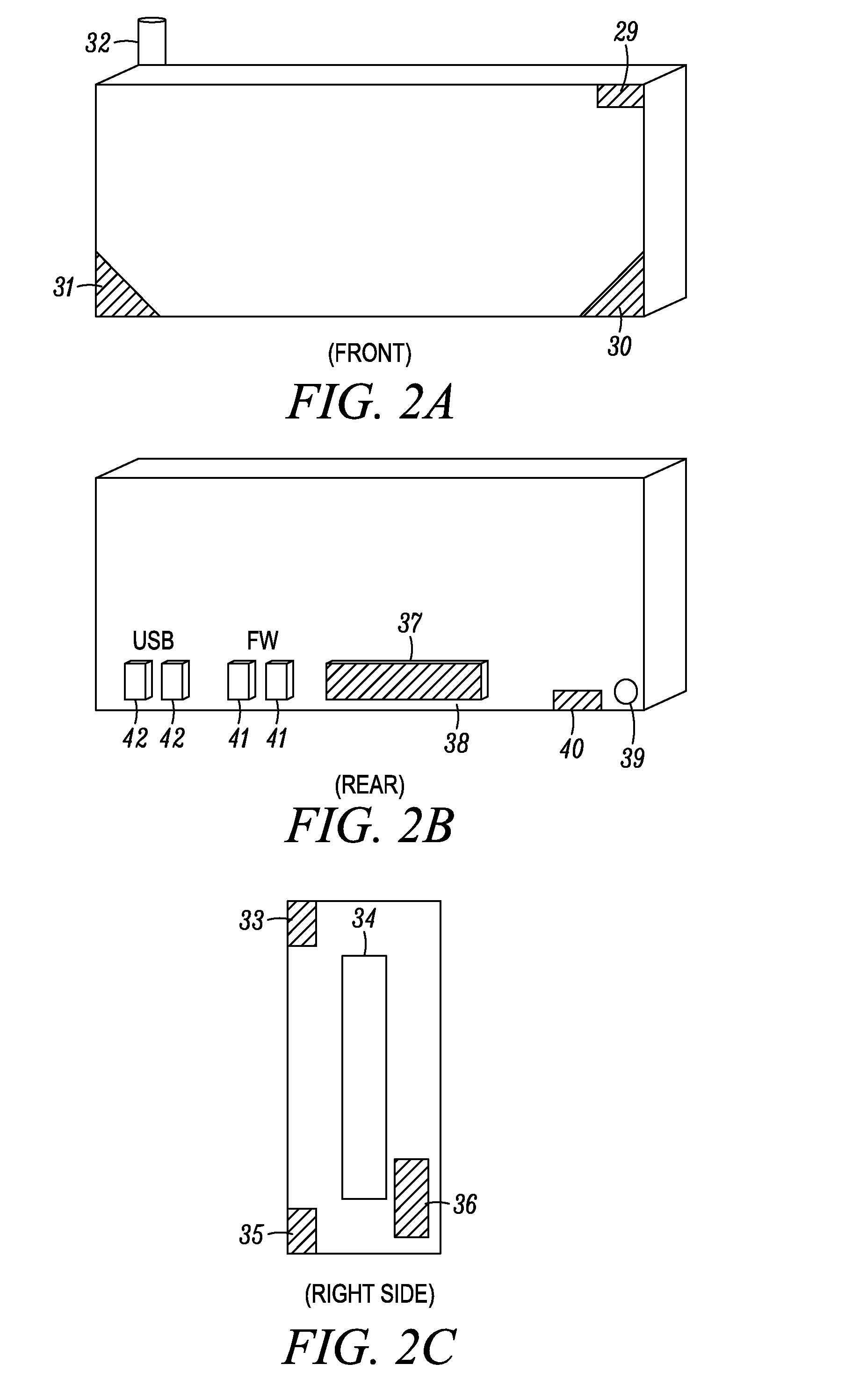

Wireless Electronic Check Deposit Scanning and Cashing Machine (also known and referred to as WEDS) Web-based Online account cash Management computer application System (also known and referred to as OMS virtual / live teller)—collectively invented integrated as “WEDS.OMS” System. Method and Apparatus for Depositing and Cashing Ordinary paper and / or substitute checks and money orders online Wirelessly from home / office computer, laptop, Internet enabled mobile phone, pda (personal digital assistant) and / or any Internet enabled device. WEDS enables verification and transmittal of image, OMS is the navigation tool used to set commands and process requests, integrated with WEDS, working collectively as WEDS.OMS System.

Owner:USAA

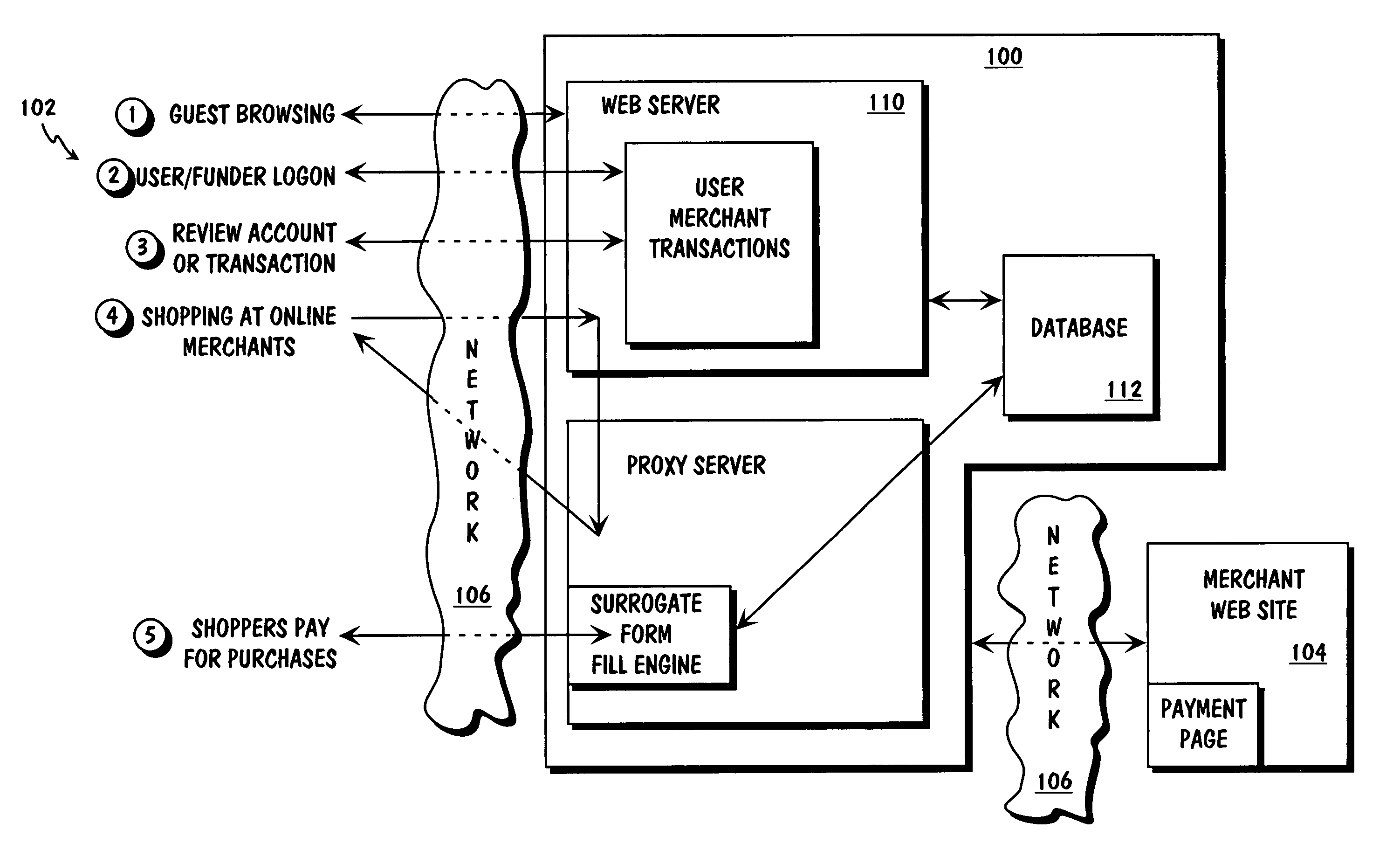

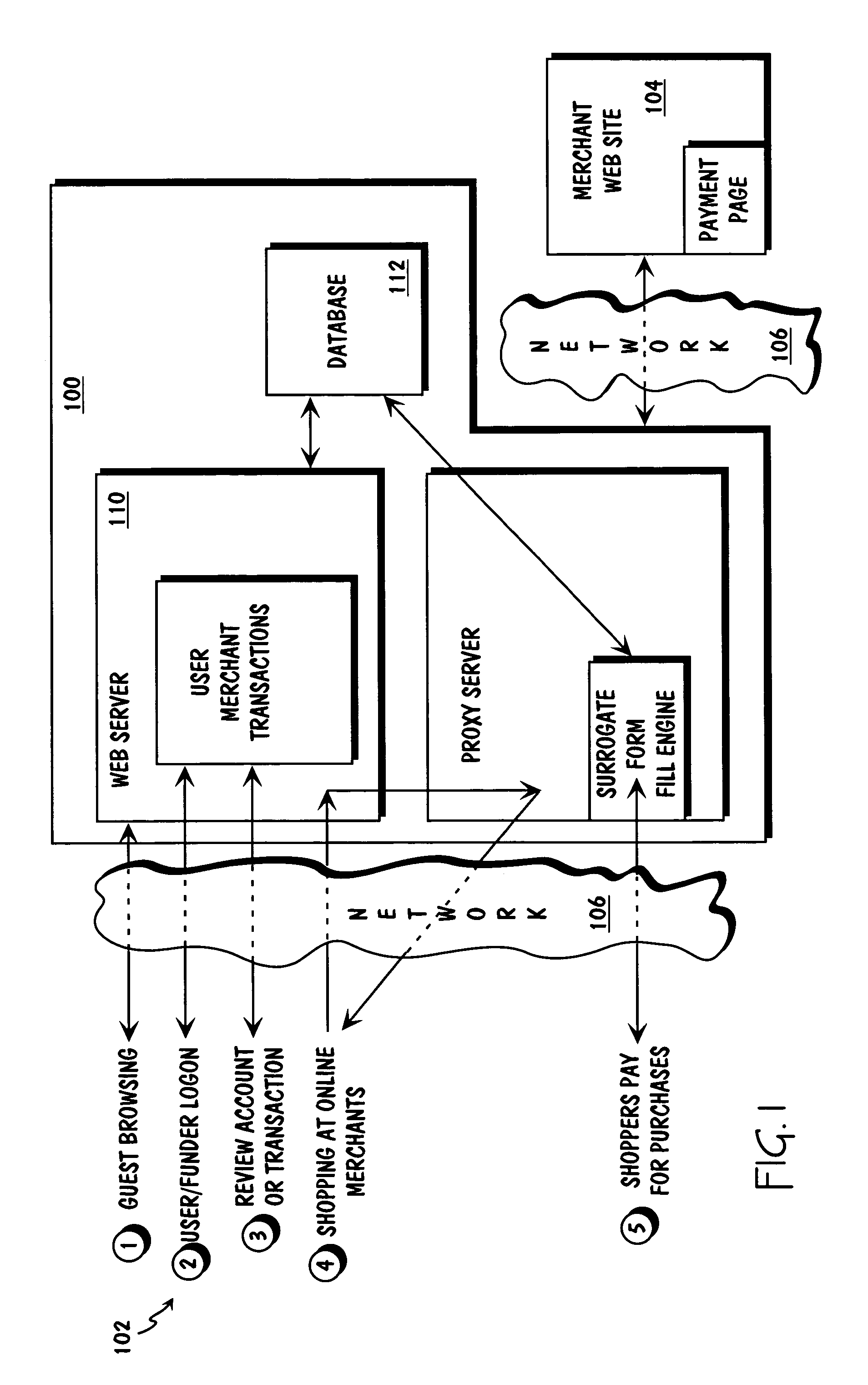

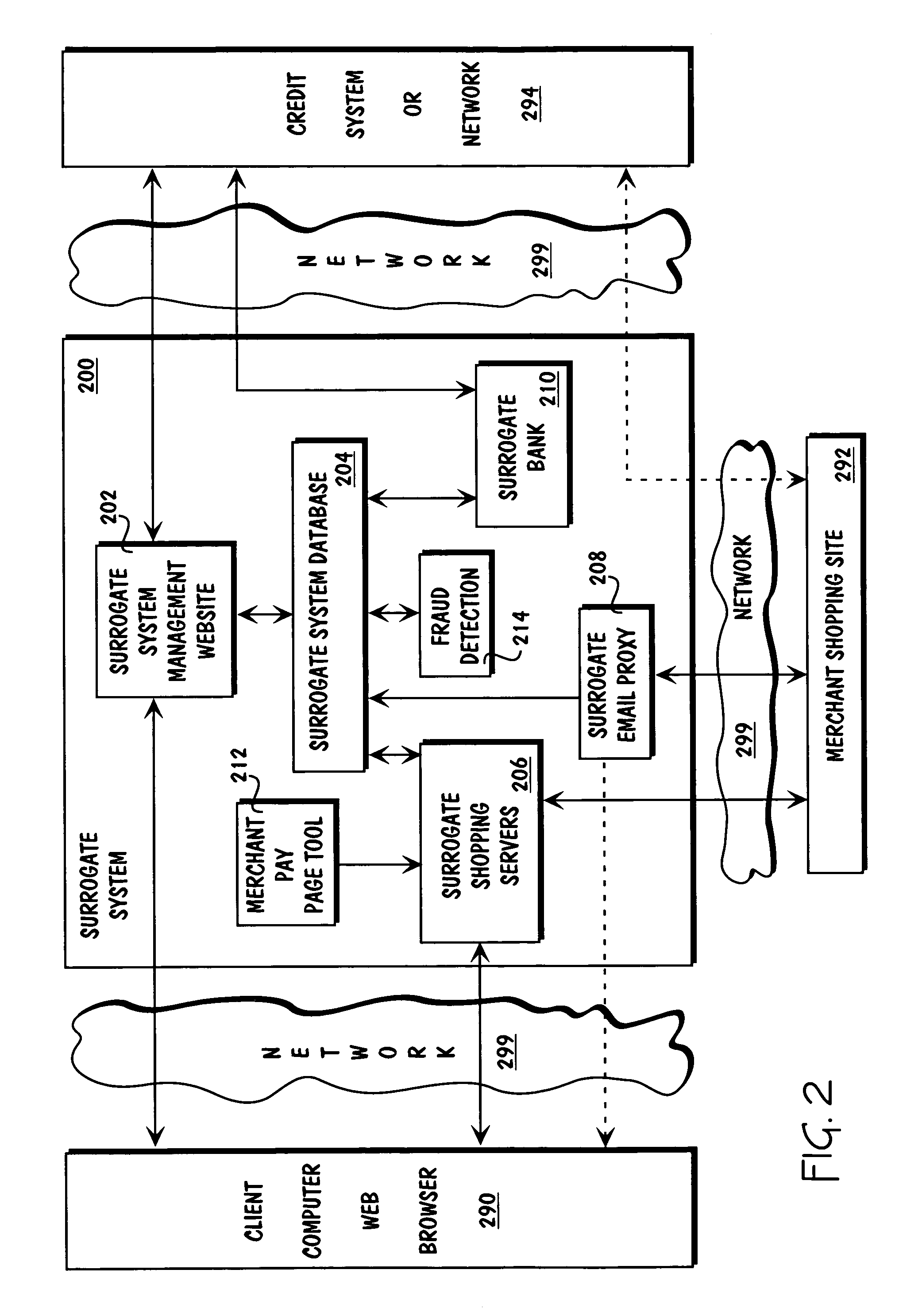

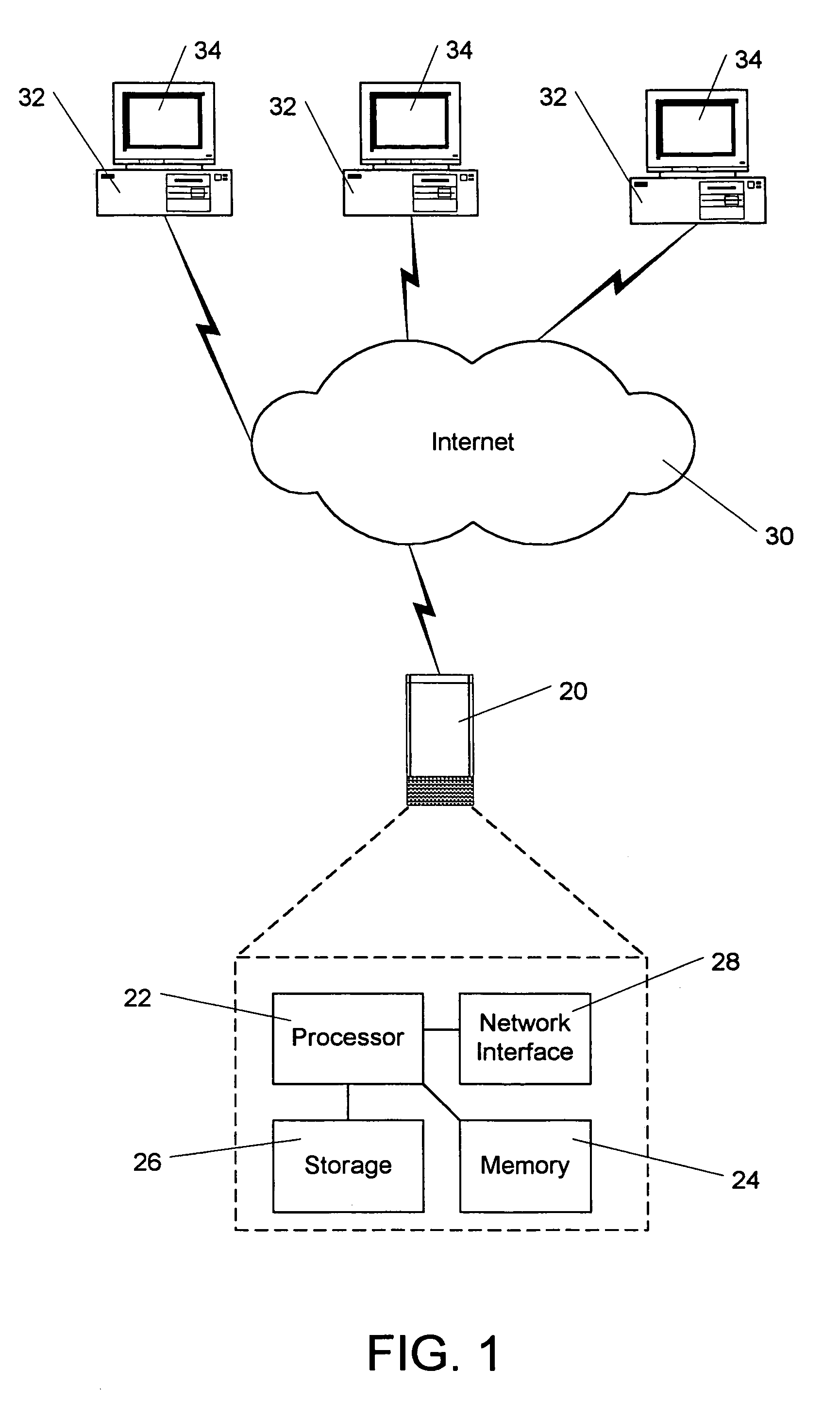

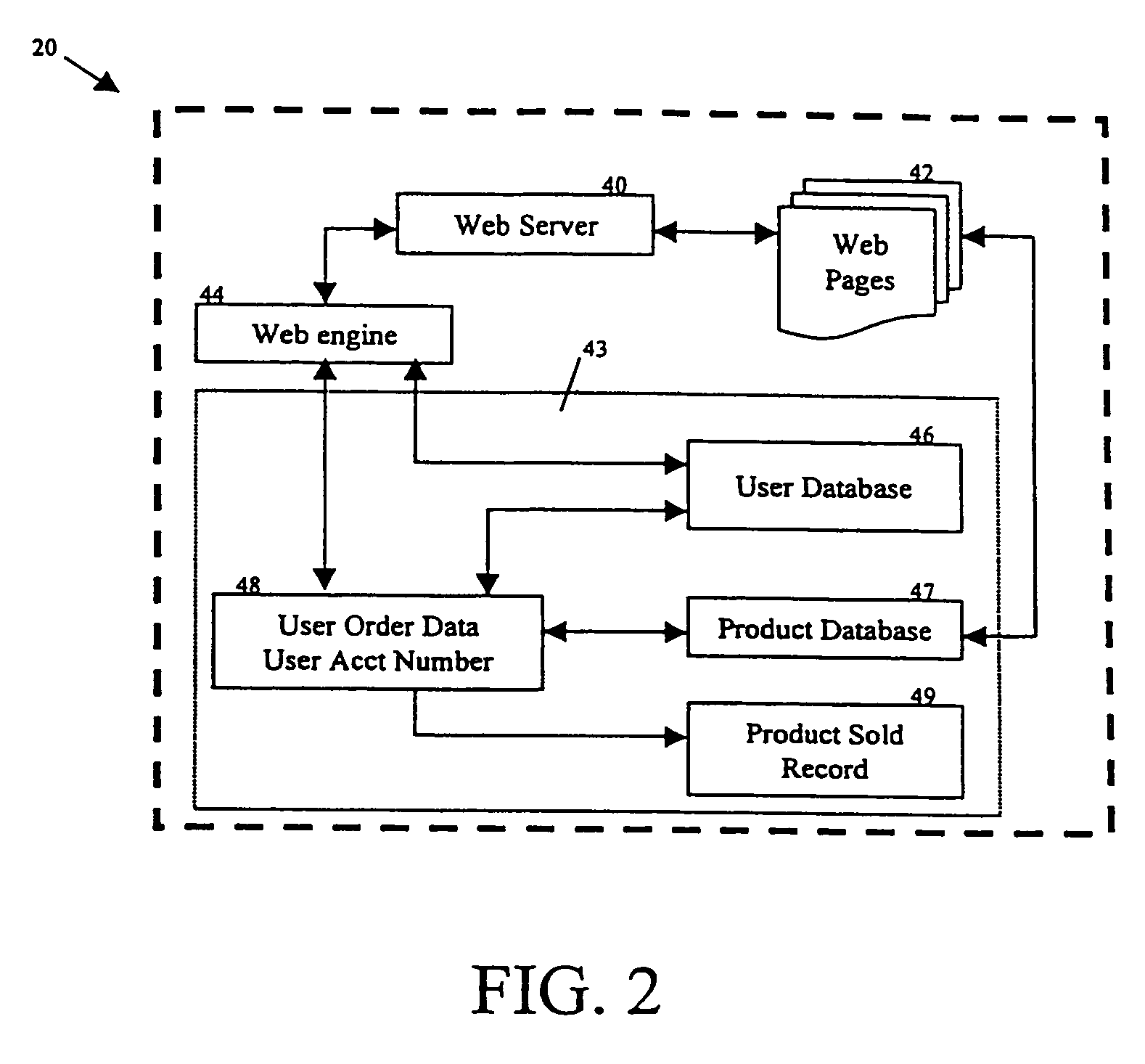

Method and apparatus for surrogate control of network-based electronic transactions

A surrogate system for the transparent control of electronic commerce transactions is provided through which an individual without a credit card is enabled to shop at online merchant sites. Upon opening an account within the surrogate system, the account can be funded using numerous fund sources, for example credit cards, checking accounts, money orders, gift certificates, incentive codes, online currency, coupons, and stored value cards. A user with a funded account can shop at numerous merchant web sites through the surrogate system. When merchandise is selected for purchase, a purchase transaction is executed in which a credit card belonging to the surrogate system is temporarily or permanently assigned to the user. The credit card, once loaded with funds from the user's corresponding funded account, is used to complete the purchase transaction. The surrogate system provides controls that include monitoring the data streams and, in response, controlling the information flow between the user and the merchant sites.

Owner:THE COCA-COLA CO

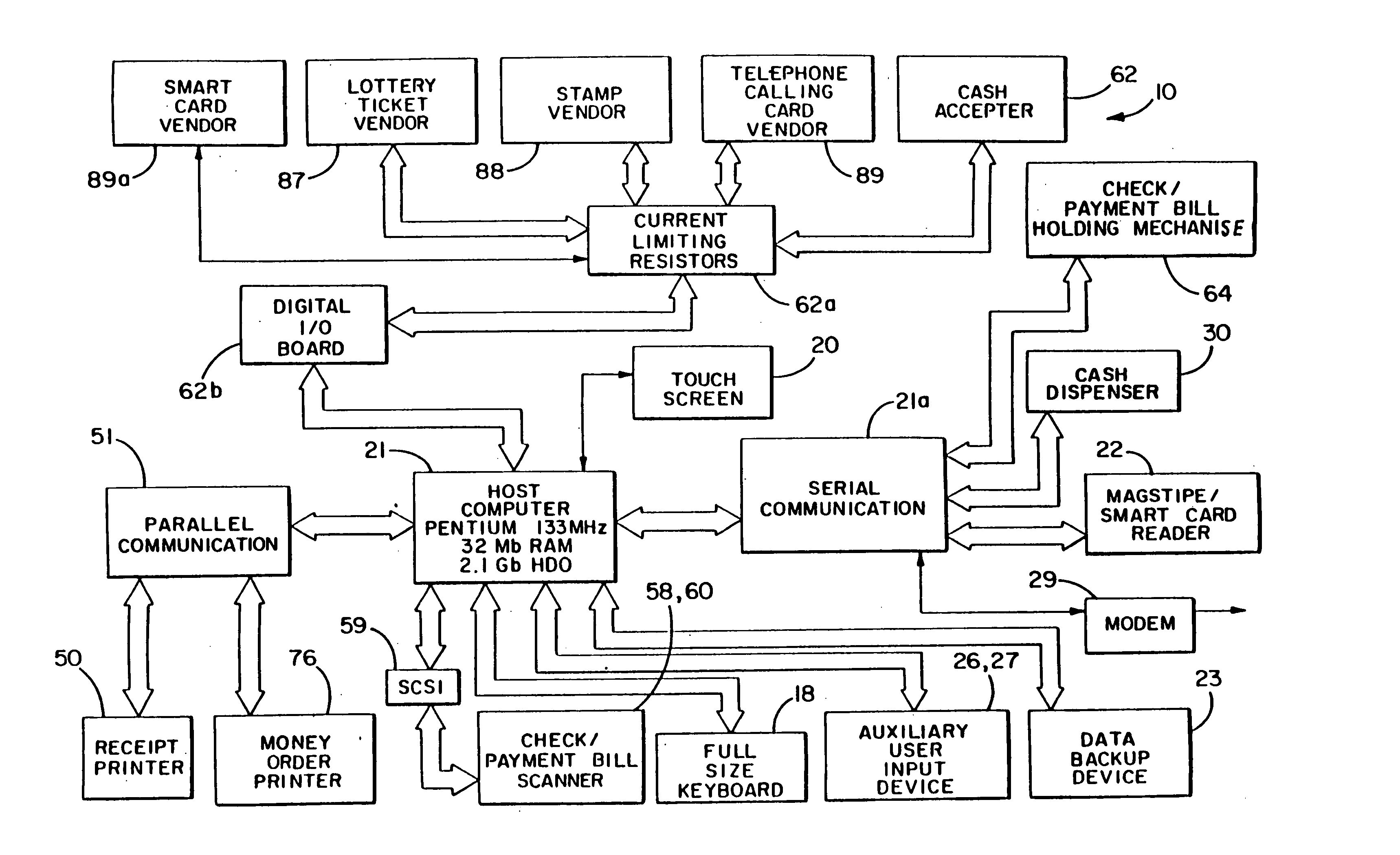

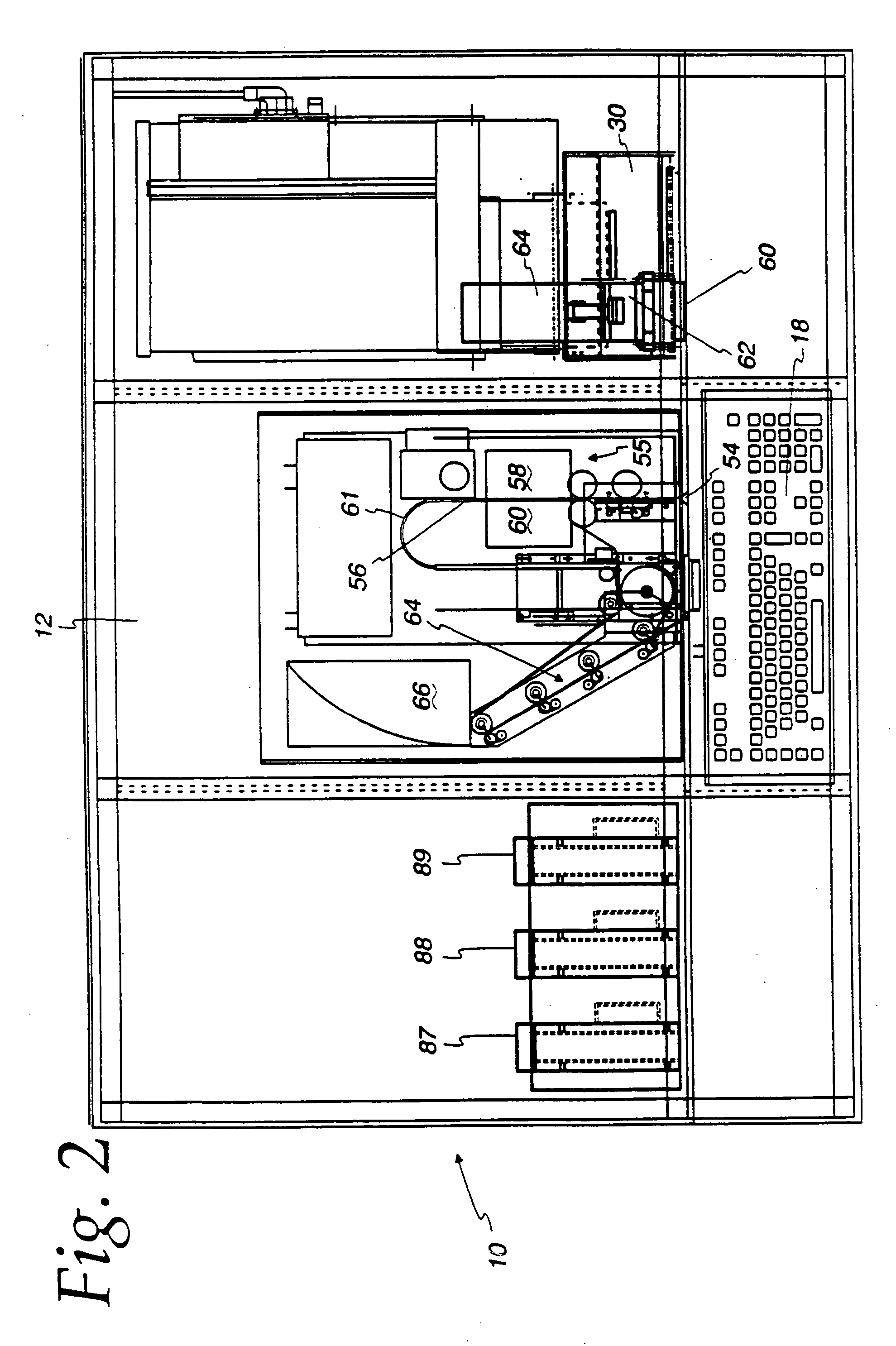

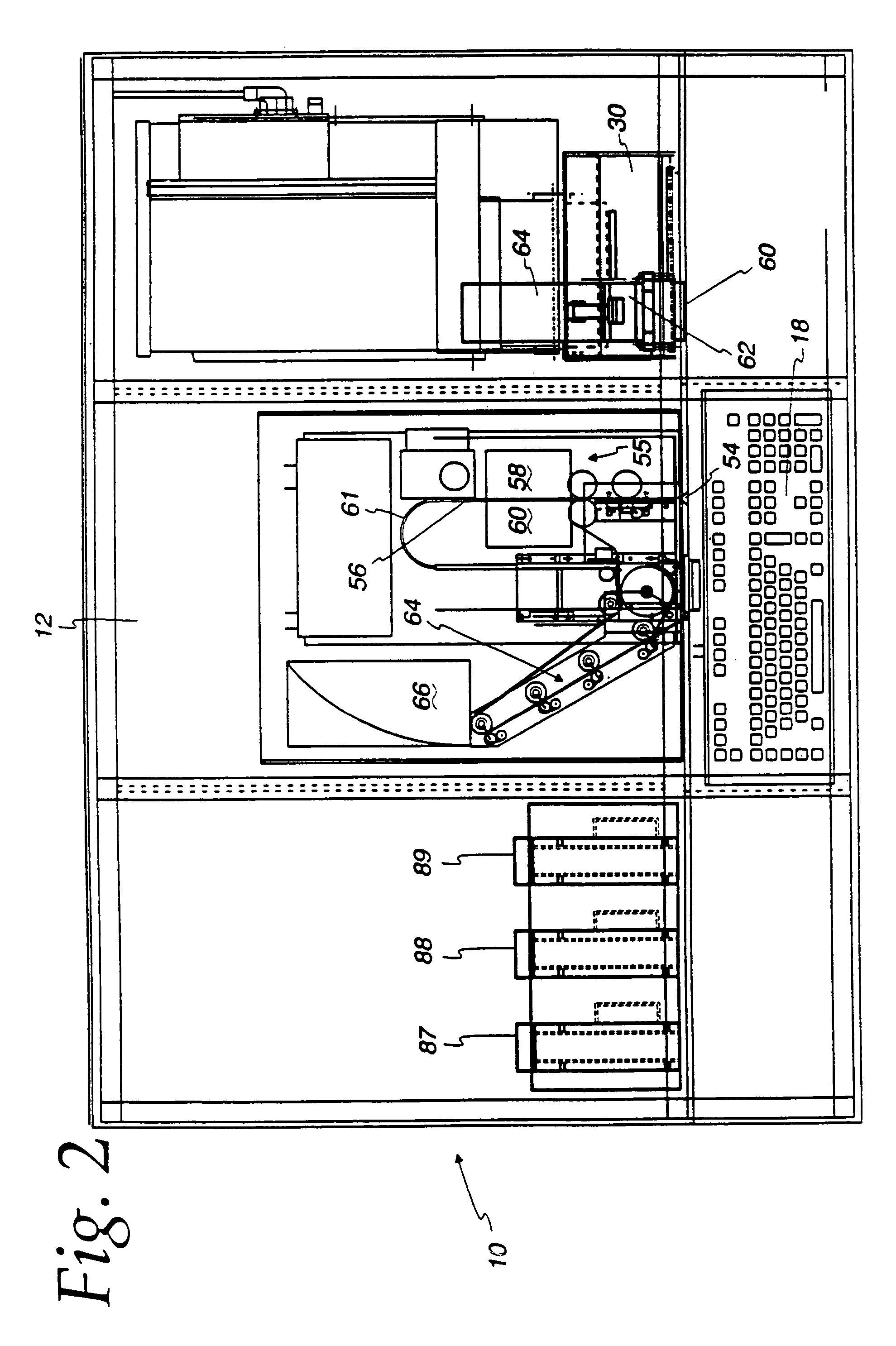

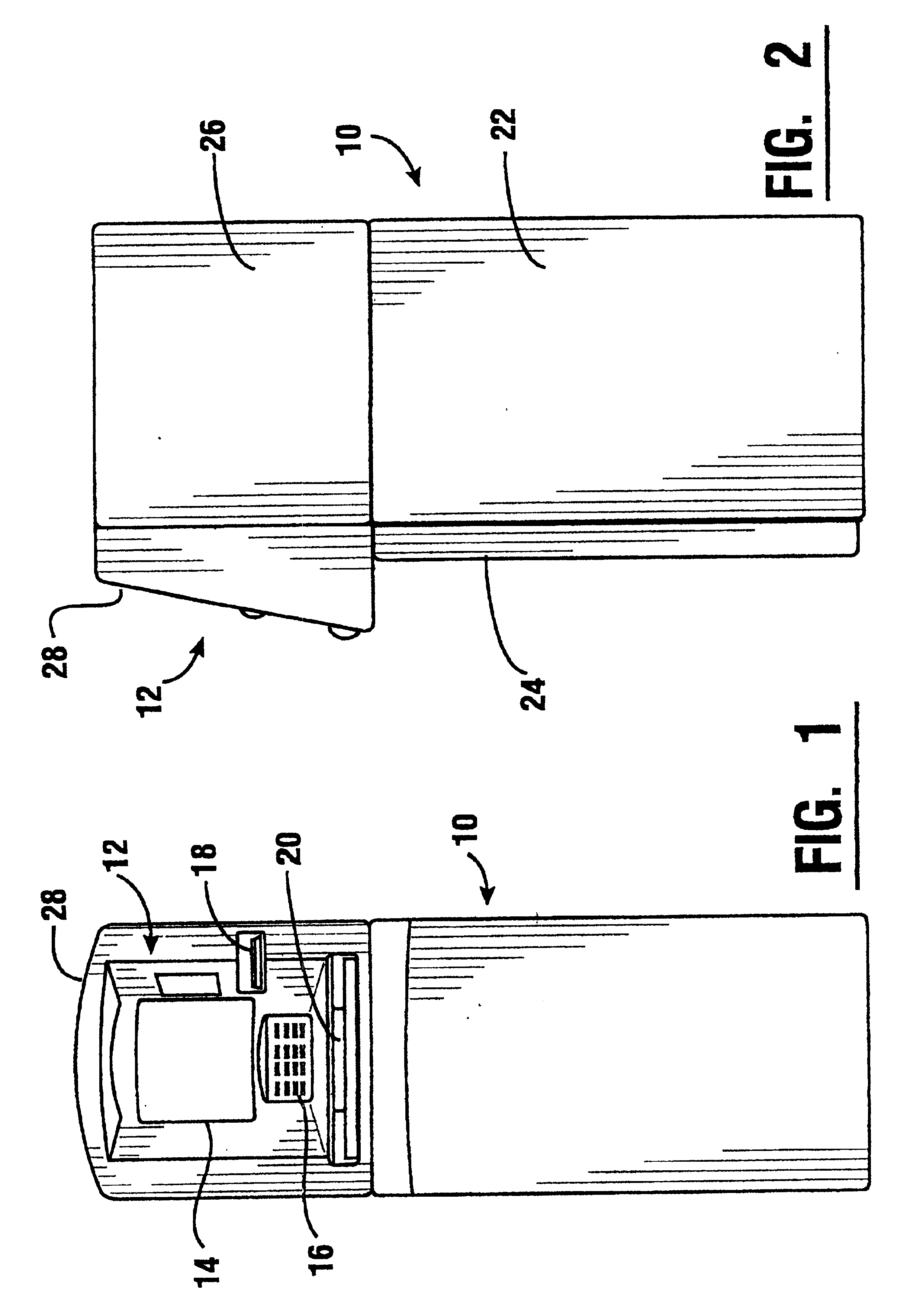

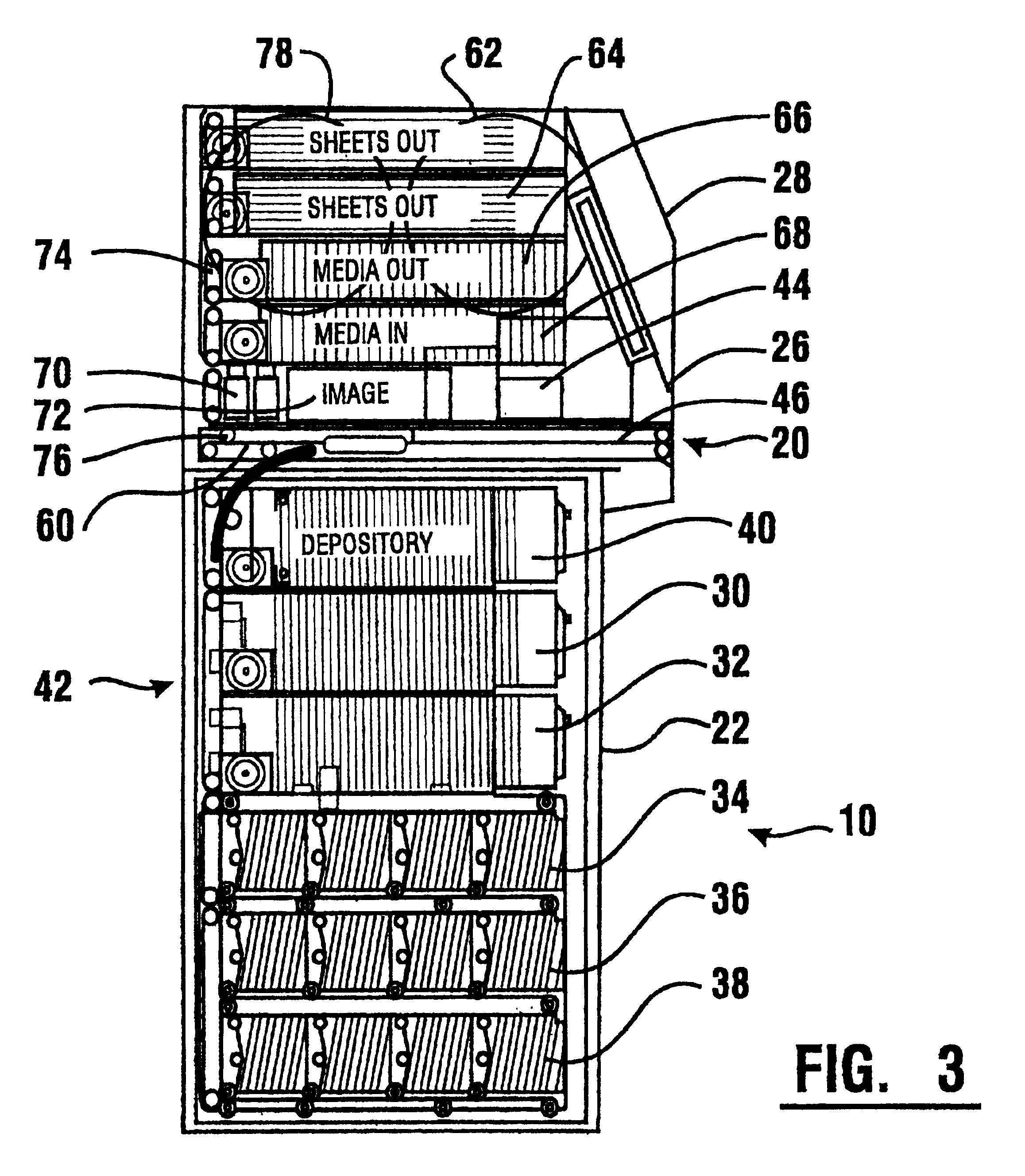

Automated document cashing system

An automated document cashing system is provided with an automated machine that cashes monetary transaction documents such as checks, money orders, and that makes deposit entries into the bank account of the user after validation of the user and monetary transaction document, without the aid of a bank teller. Validation of the identity of the user is performed with the use of a card associated with intelligence that identifies the user. A biometric device also may be used in identifying the validity of the user. Validation of the document involves one or more of: validating the presence of a signature; validating the amount of the monetary transaction document including a manual entry of the amount by the user; validating CAR against the LAR; and validating the banking system parameters and rules for the customer and / or the transaction. To assist in the automatic analysis of data on monetary transactional documents or on remittance documents, the user is prompted to provide a bounding box about the data. An image touch screen may be touched by the user to locate the bounding box and the user may magnify the data to fill the boundary box to exclude other data from this analysis. After document and person validation, the system will dispense money or transfer monies to a savings account, a checking account, a smart card, or the like. The system will also write money orders or wire transfer money. By supplying monies in the form of cash, credit card authorization, smart card balance, or the like to the machine, the user can pay bills such as a utility bill through the system or purchase items dispensed by the system.

Owner:UTILX CORP +2

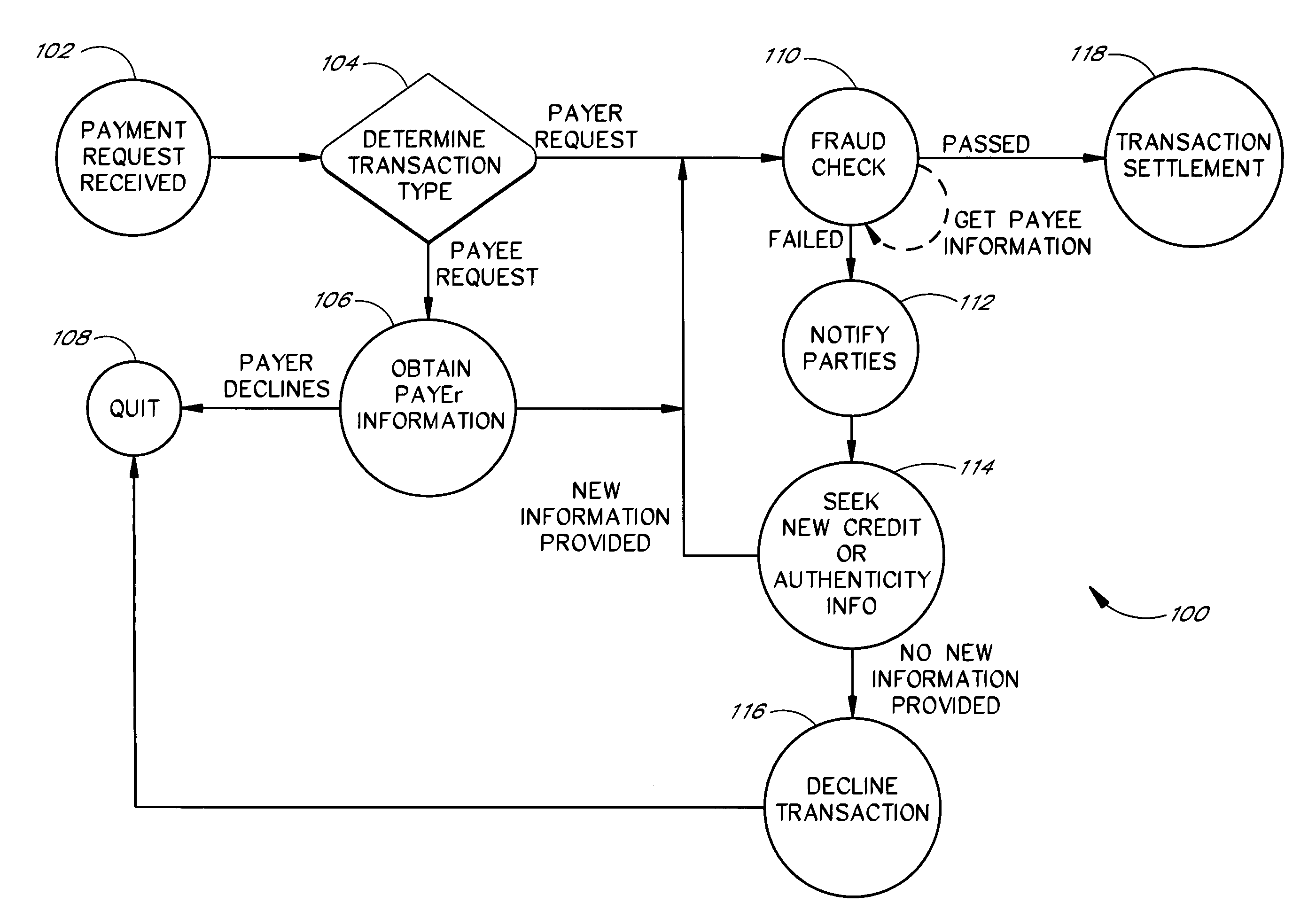

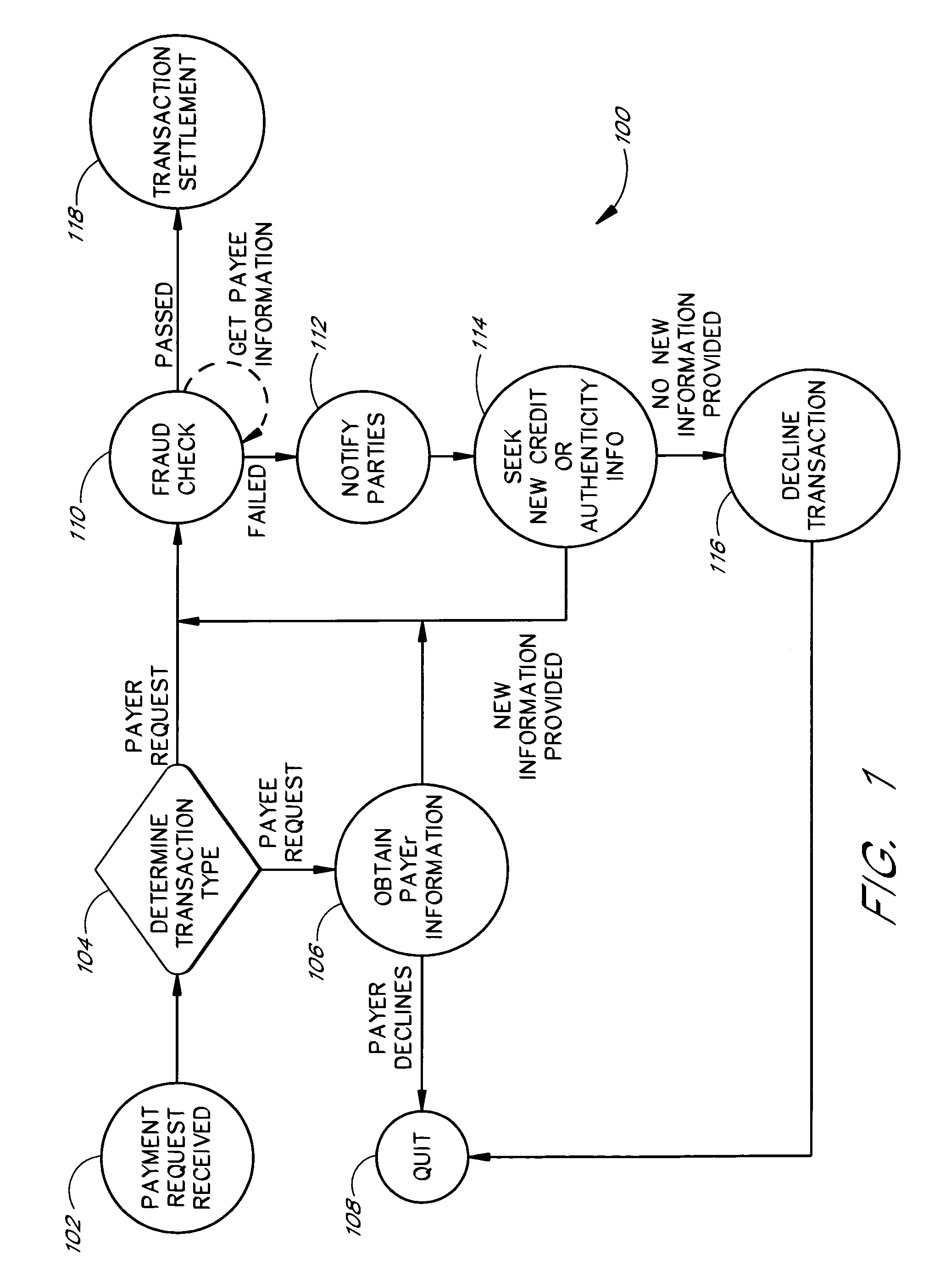

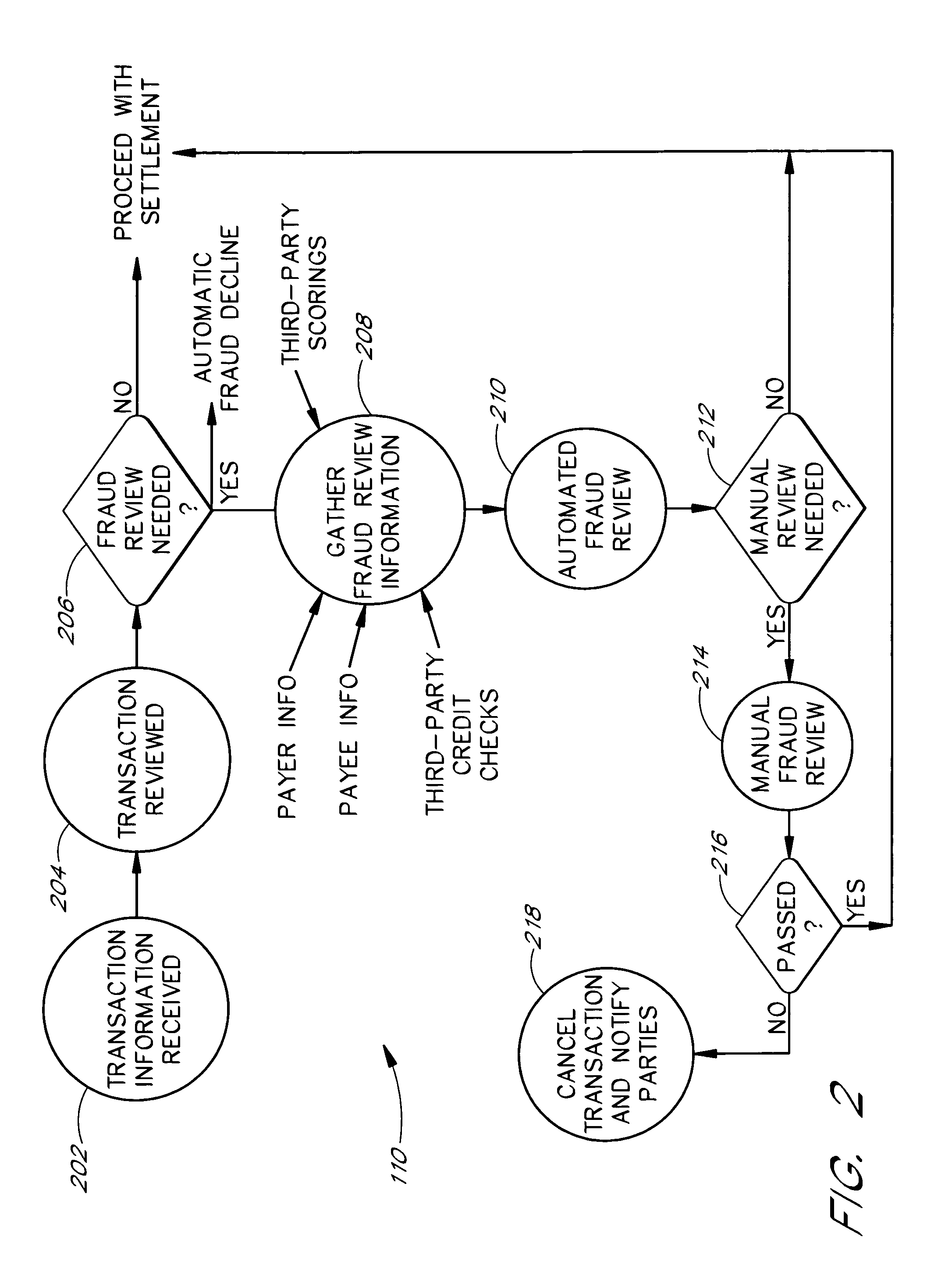

Computer-assisted funds transfer system

A payment request associated with a transfer of funds is received and a risk management assessment for both sides thereof is performed. If the risk management assessment procedure produces an adverse indication, the payment request is declined. Otherwise, the payment request may be processed for delivery of a payment associated therewith. The risk management assessment may be performed on the basis of credit / authentication information derived from customer information received with (or even prior to) the payment request. Such customer information may include credit card account information and / or bank account information (e.g., checking account) information. In some cases, the risk management assessment may include an automated component and a manual (non-automated) component. Such a manual component may be needed where the automated component of the risk management assessment provides suspect information regarding one of the parties to the transaction. Where the payment request is processed for delivery of the payment, such processing may include submitting a payment authorization request, and, upon receiving a settlement indication regarding that payment authorization request, transmitting the payment. In some cases, the payment may be transmitted as a check, while in others it may be transmitted as a money order or instruction to have funds automatically deposited in an account.

Owner:AMAZON TECH INC +1

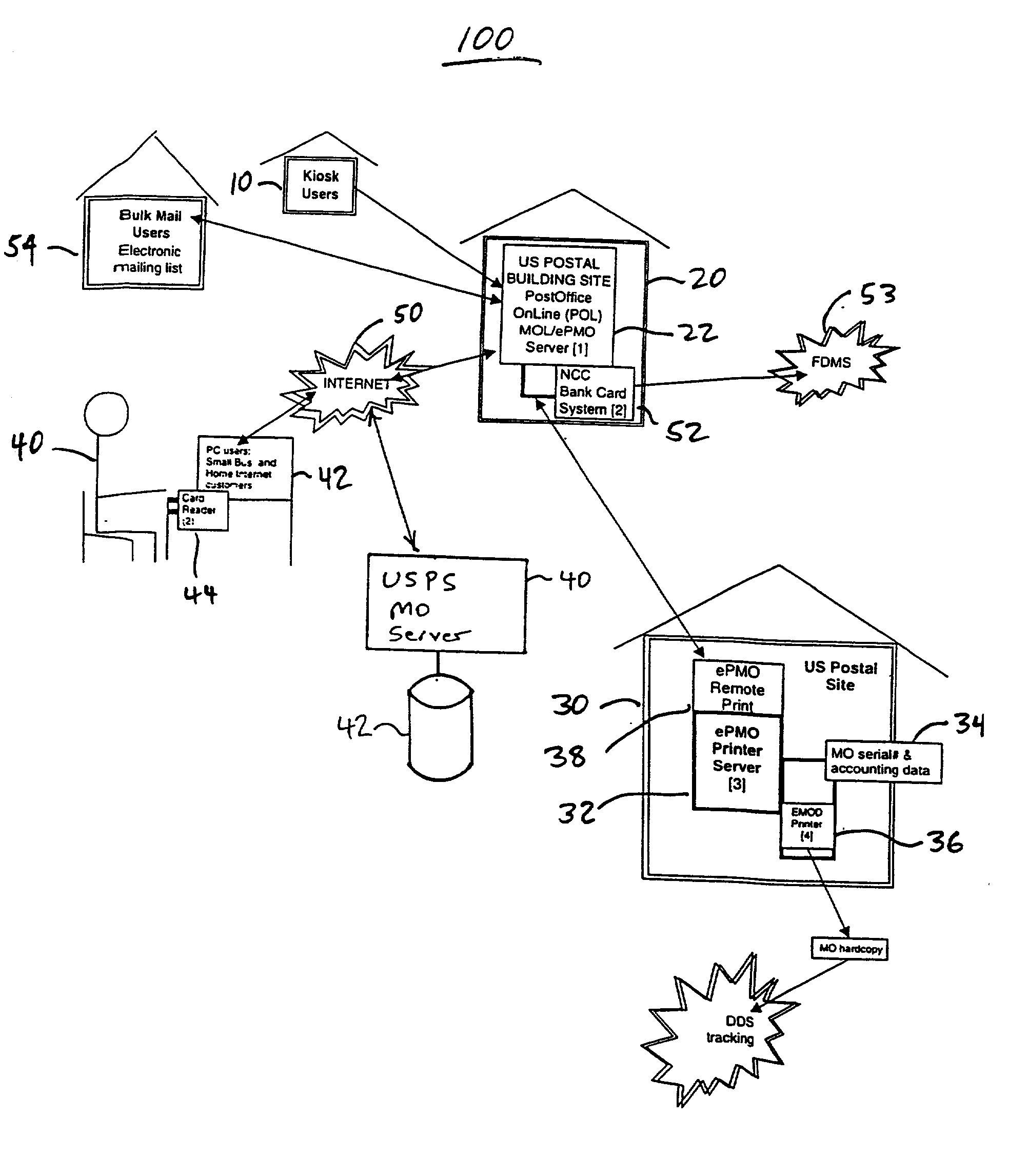

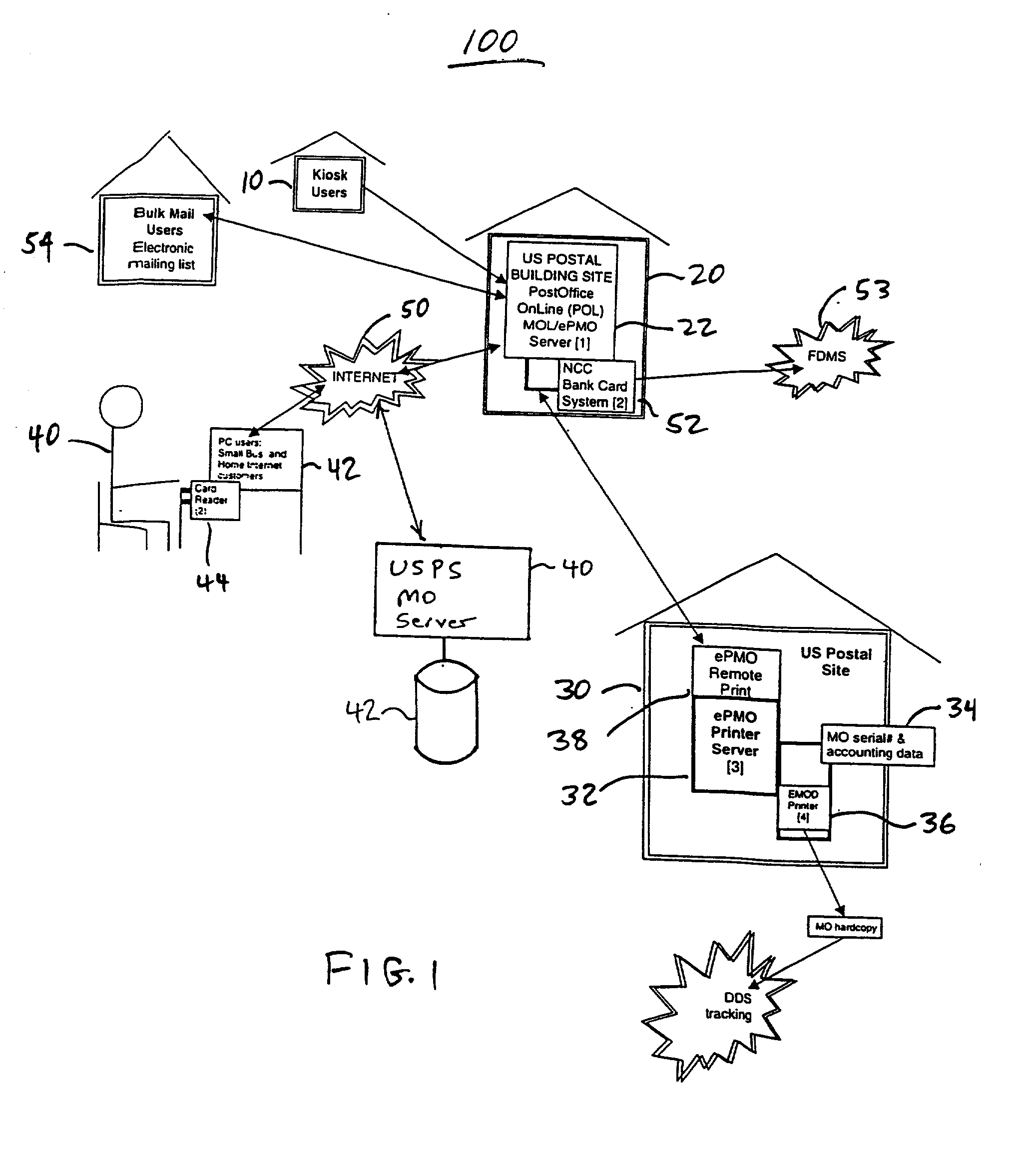

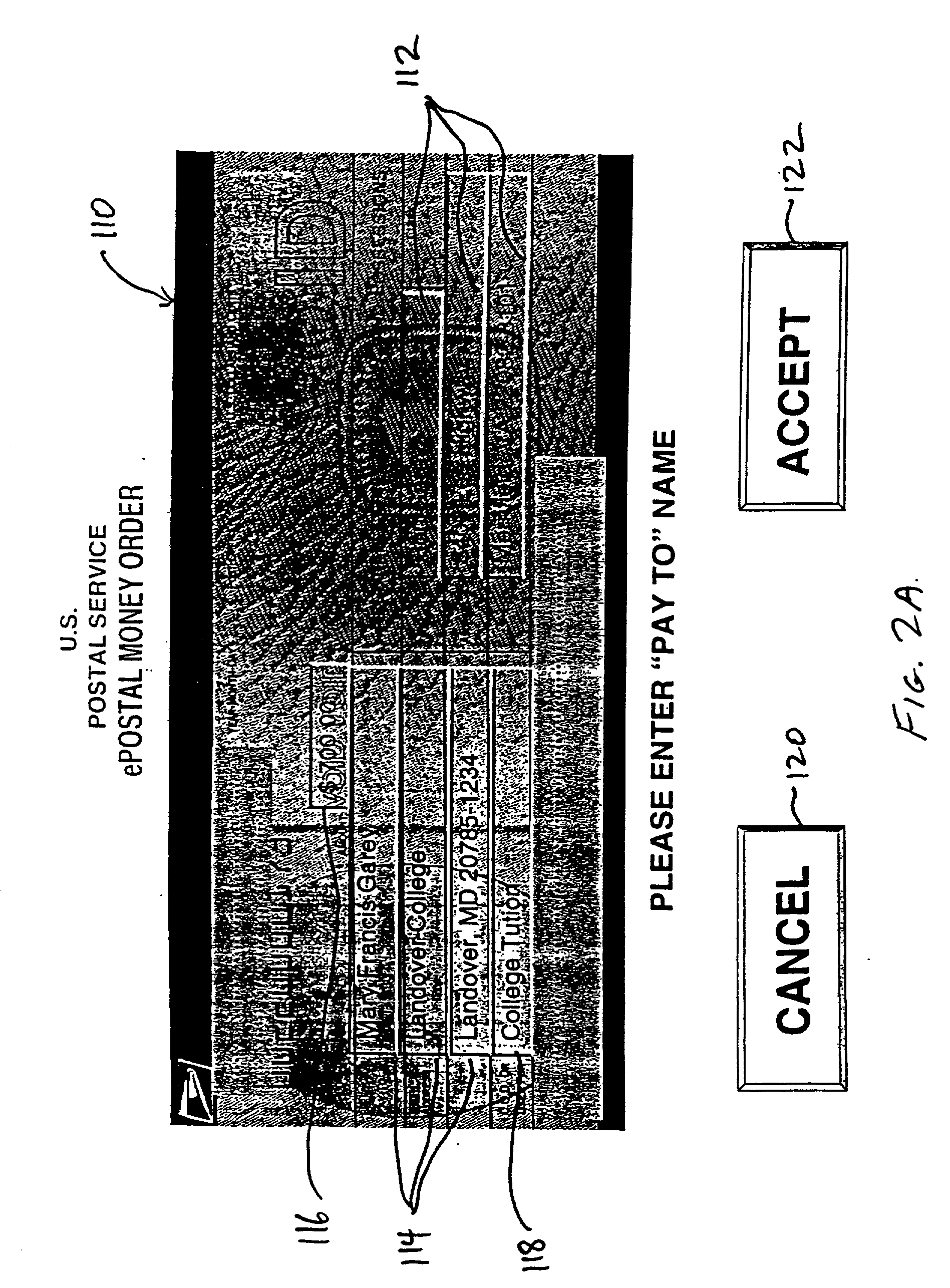

Electronic postal money order method and system

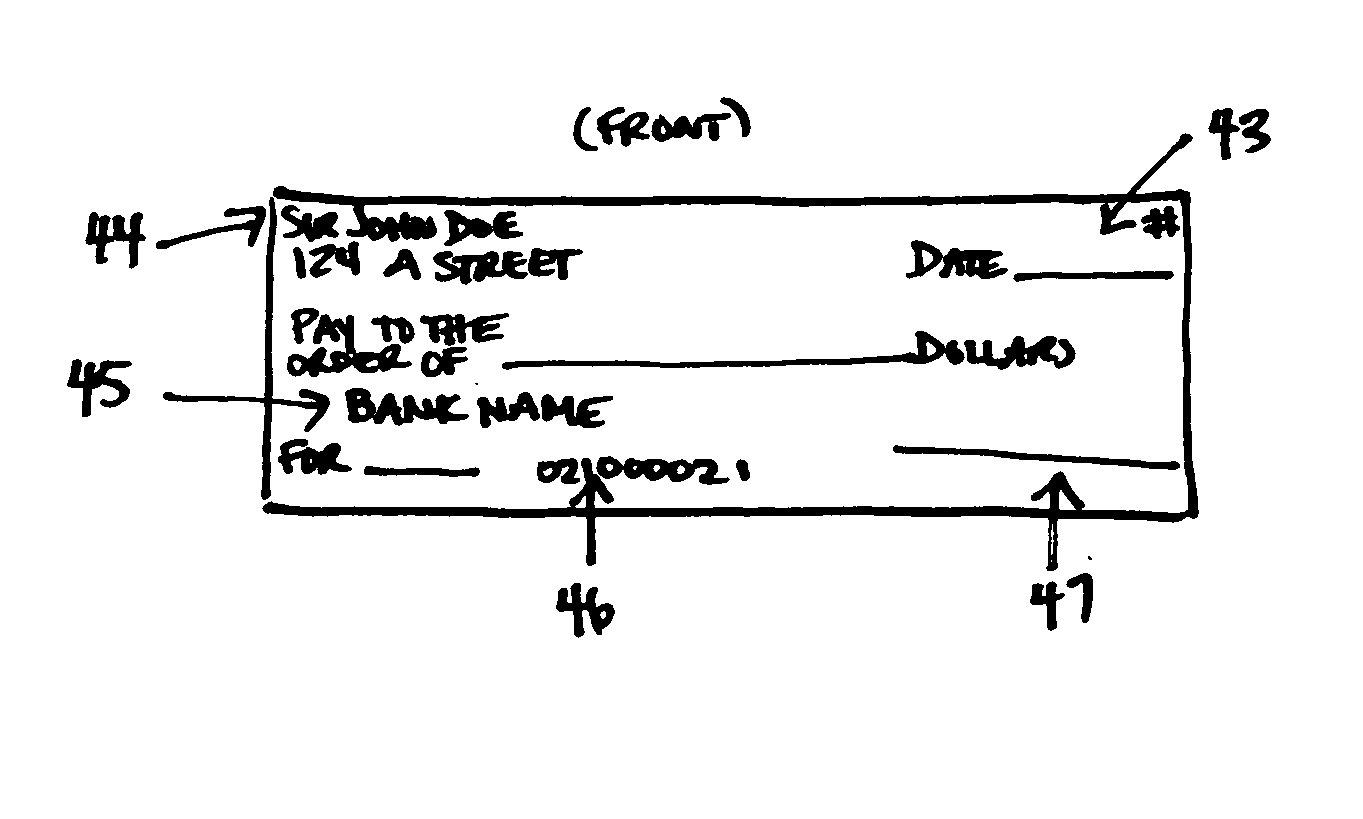

Provided is an electronic postal money order system and method comprising the purchase and fulfillment of a money order, having the steps of inputting, through a computer, money order identifying data, comprising at least the amount of the money order and addressee data and inputting payment authorization data through a payment authorization terminal. The system also transmits the money order identifying data and payment authorization data to a central server, authenticates the payment authorization data and, upon such authentication, prints a money order corresponding to the inputted money order identifying data and mails the money order to the addressee.

Owner:US POSTAL SERVICE

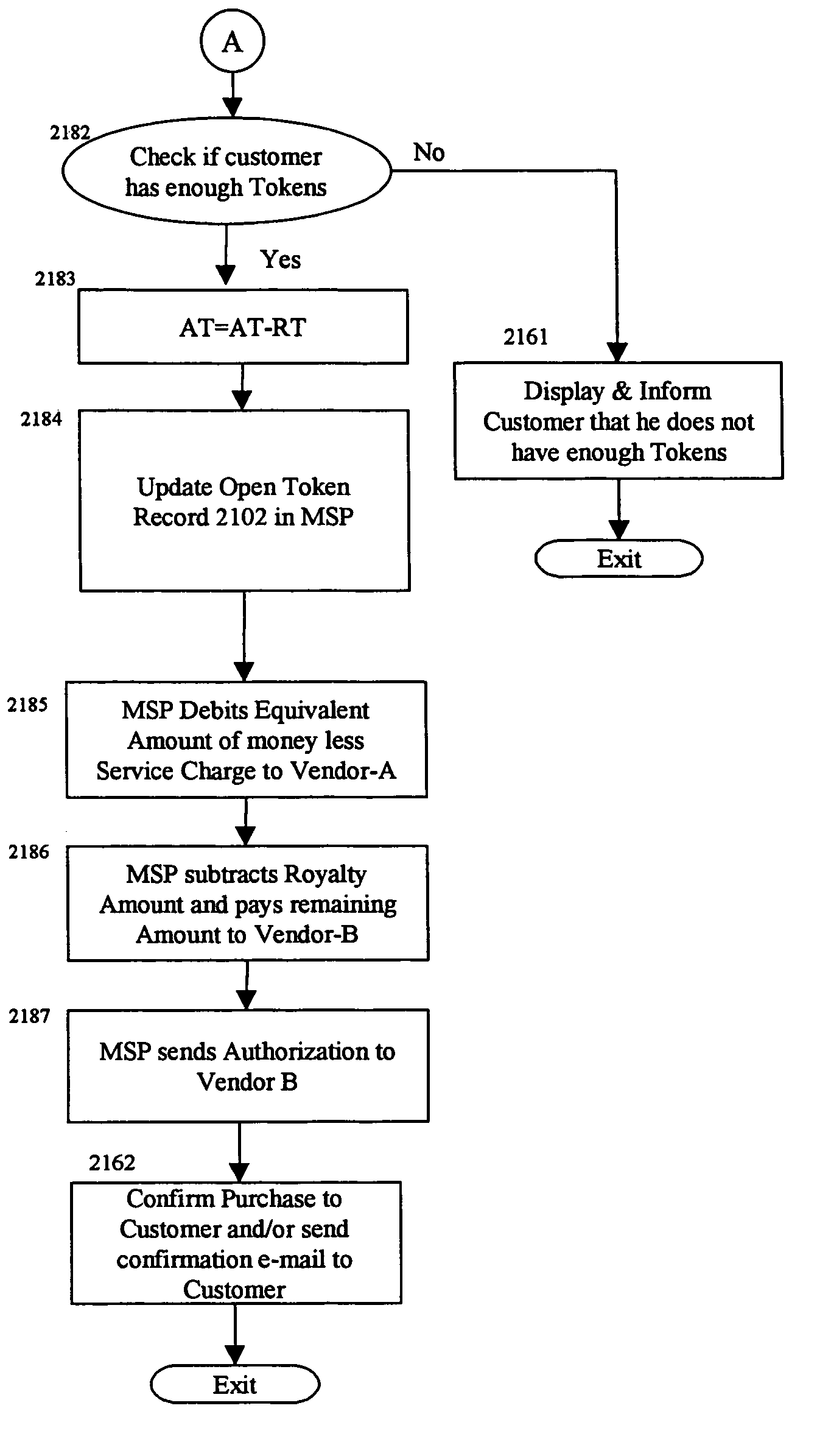

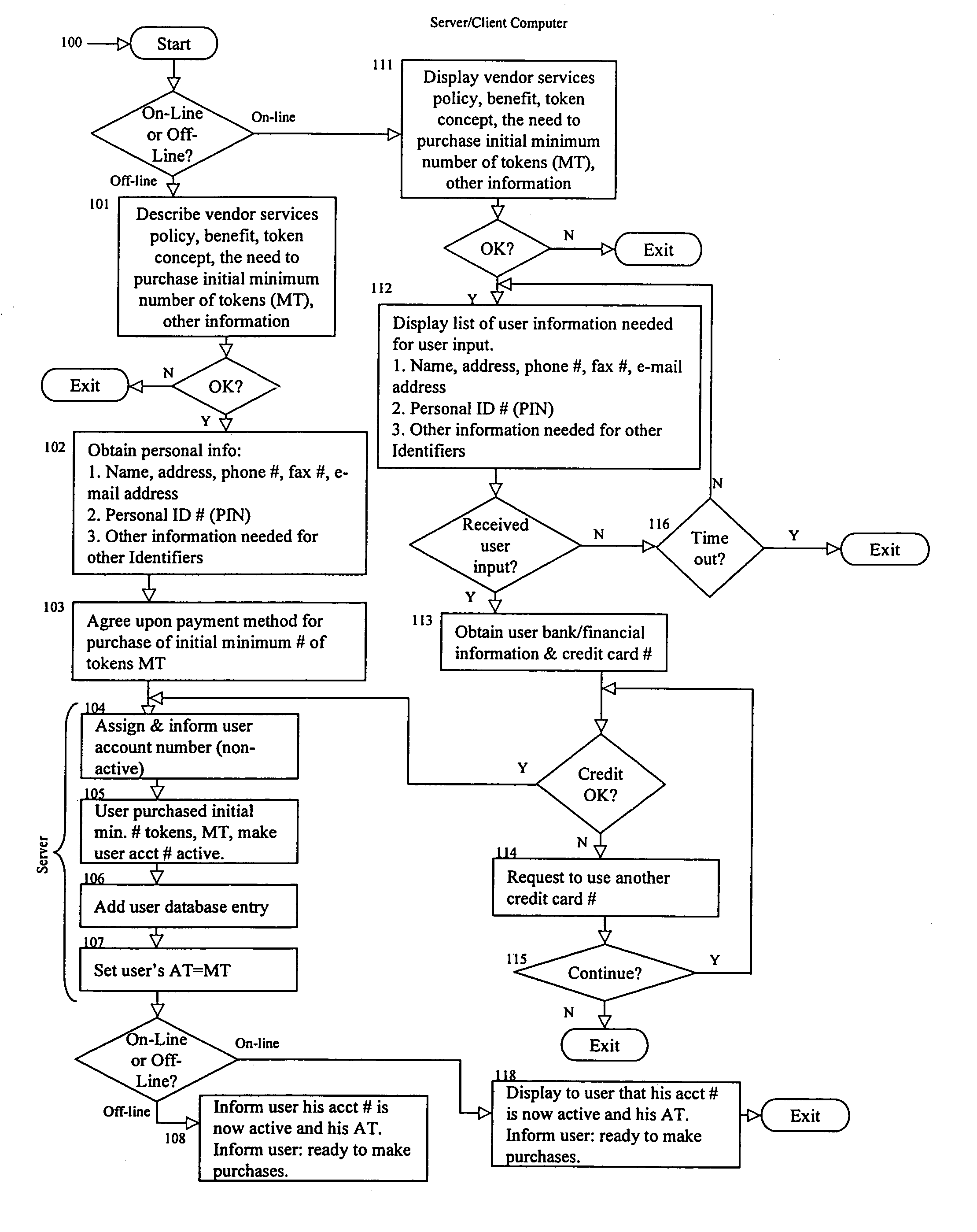

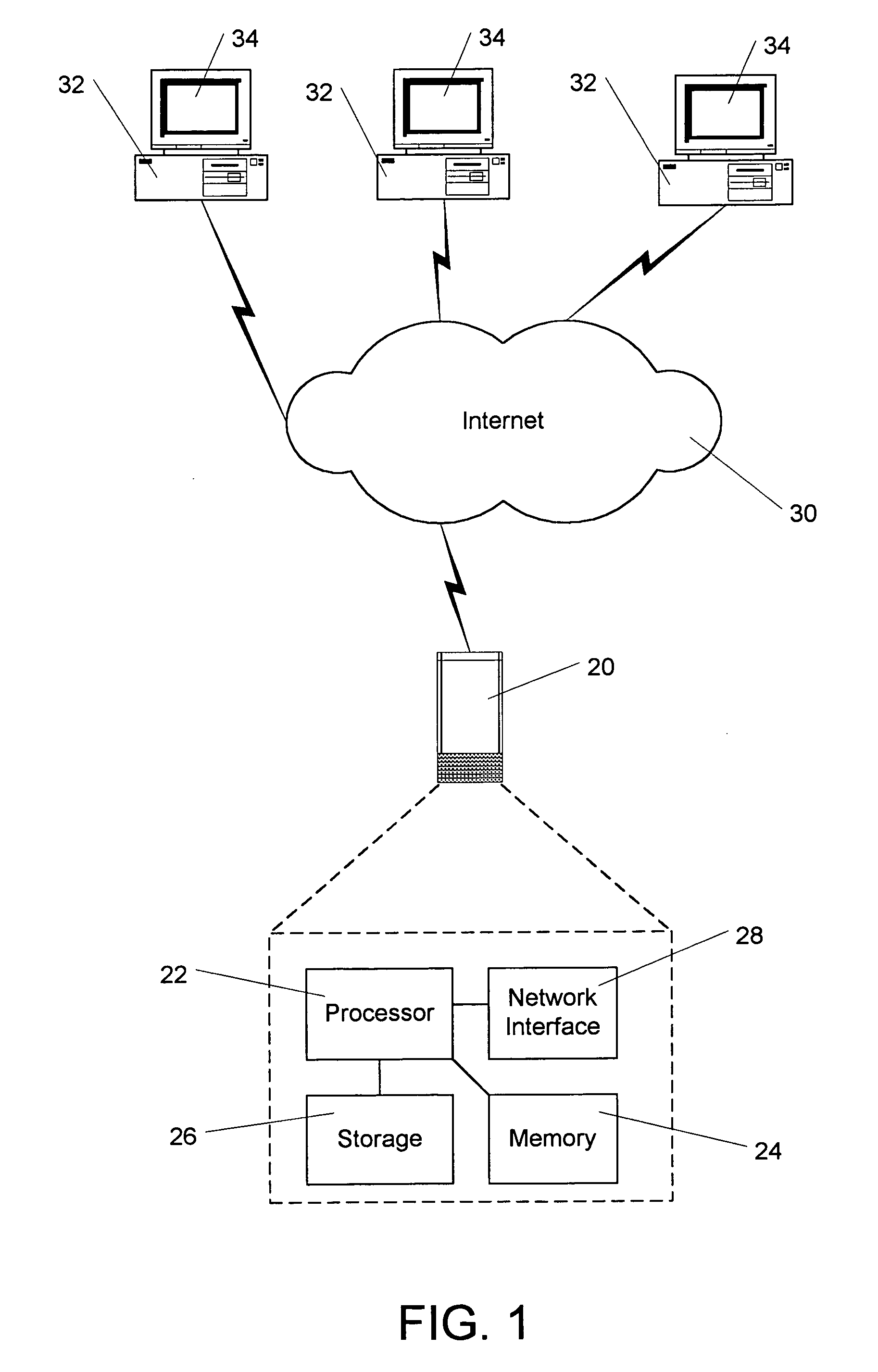

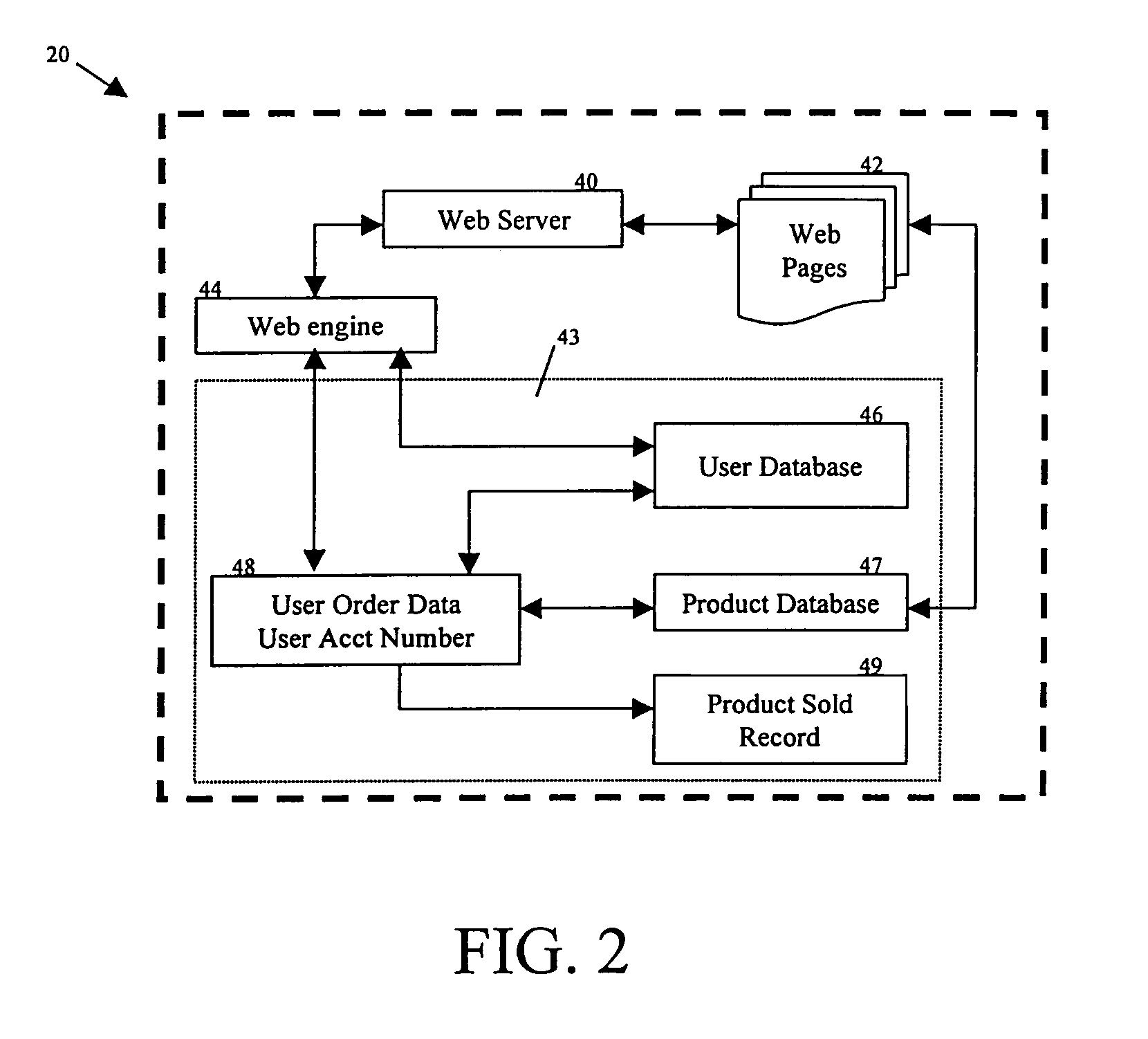

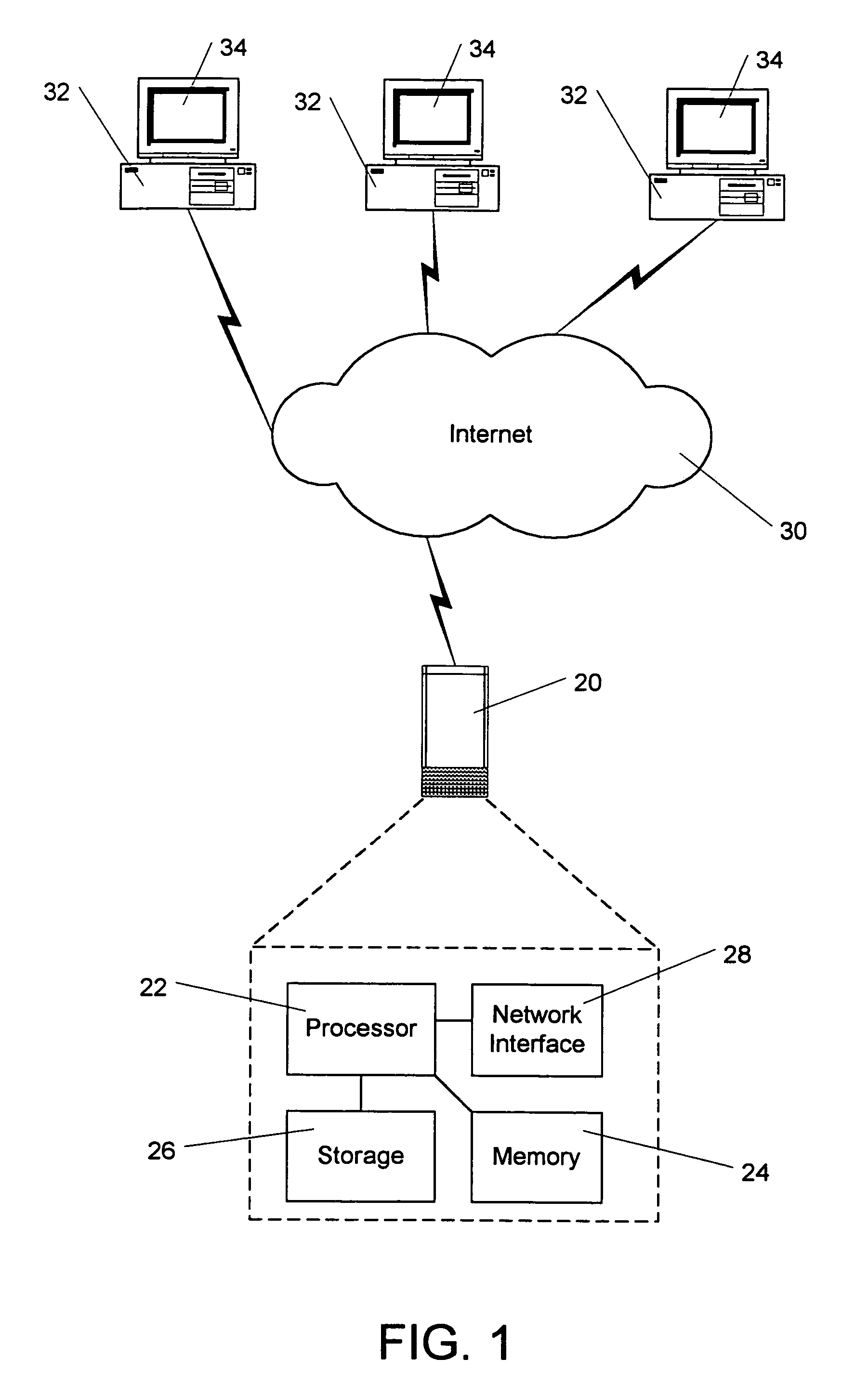

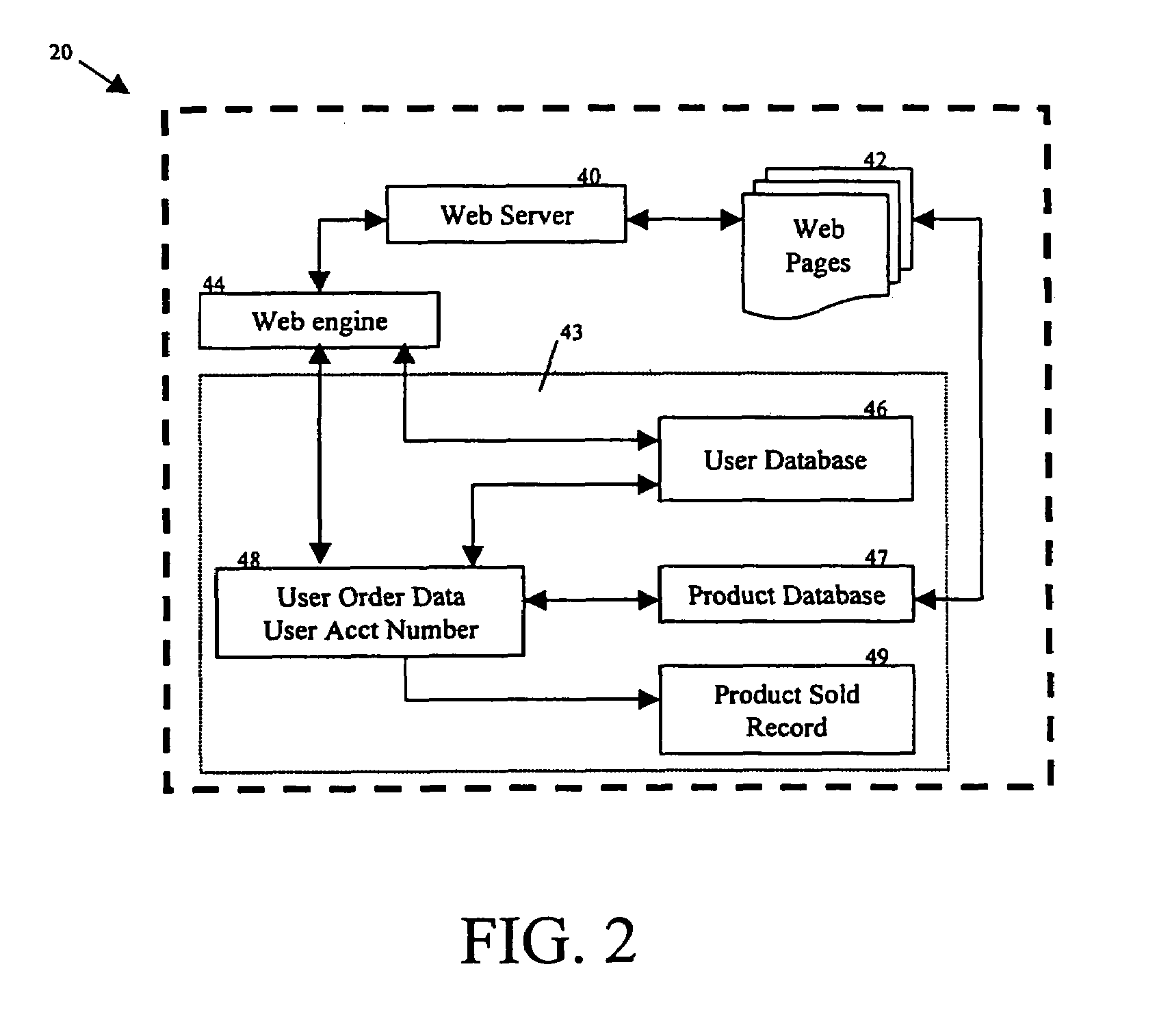

Method and apparatus for conducting electronic commerce transactions using electronic tokens

Methods and apparatus for conducting electronic commerce using electronic tokens are described. The electronic tokens are issued and maintained by a vendor, who also provides products and services that can be purchased or rented using the electronic tokens. The electronic tokens may be purchased from the vendor either on-line, using a credit card, or off-line, using a check, money order, purchase order, or other payment means. Because the vendor is the issuer of the electronic tokens, there is no need for transactions to be handled by a third party, such as a bank or other organization. This reduces the overhead involved in conducting electronic commerce, and provides the vendor with a greater amount of control. Additionally, the vendor maintains total control over the price of the electronic tokens at any time. For vendors who offer software products for sale or rental, use of electronic tokens makes a variety of rental arrangements practical. Additionally, a user registers and purchases electronic tokens at the vendor. The user may purchase products at any other vendors who conduct electronic commerce using electronic tokens.

Owner:AML IP LLC

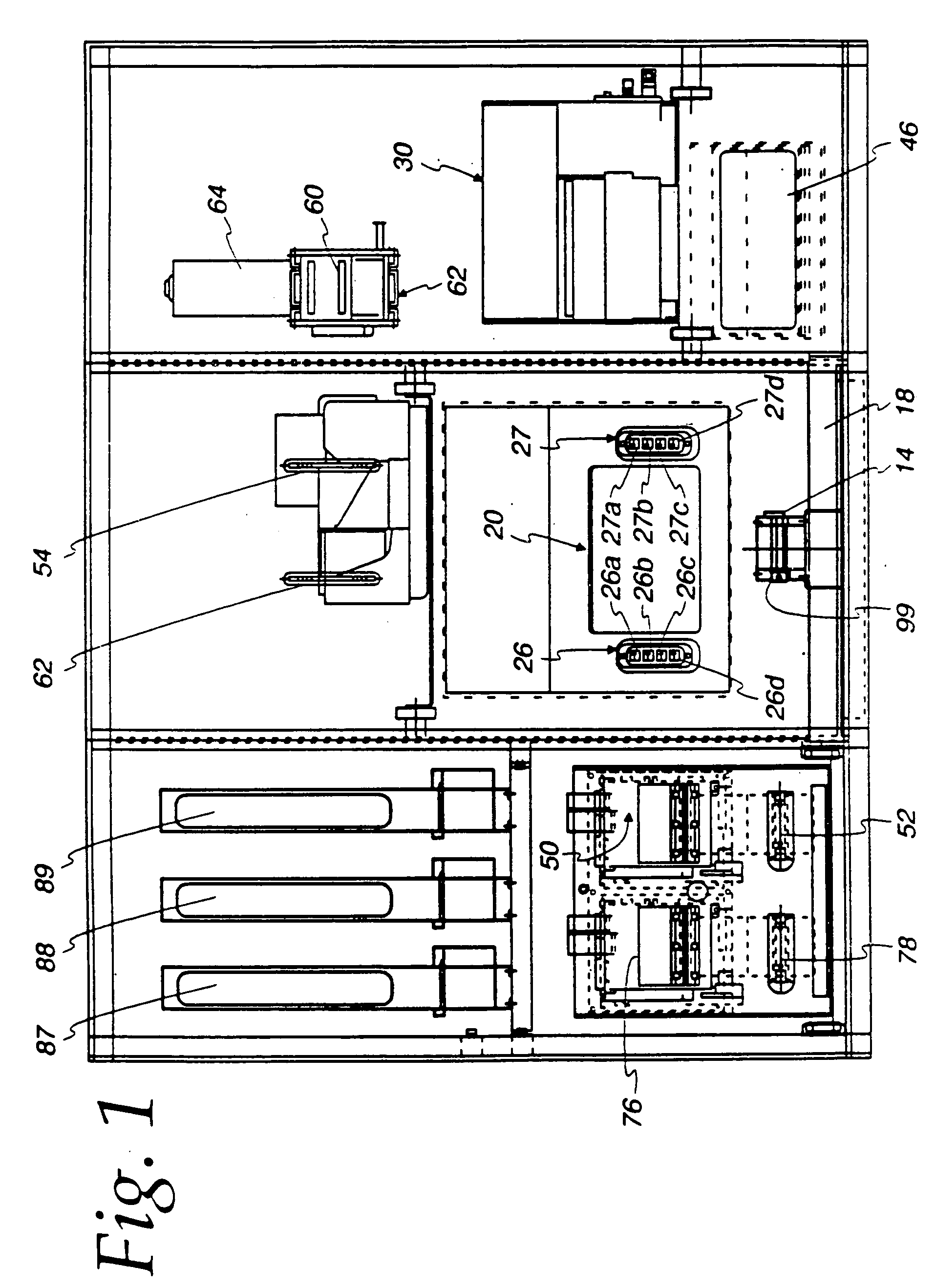

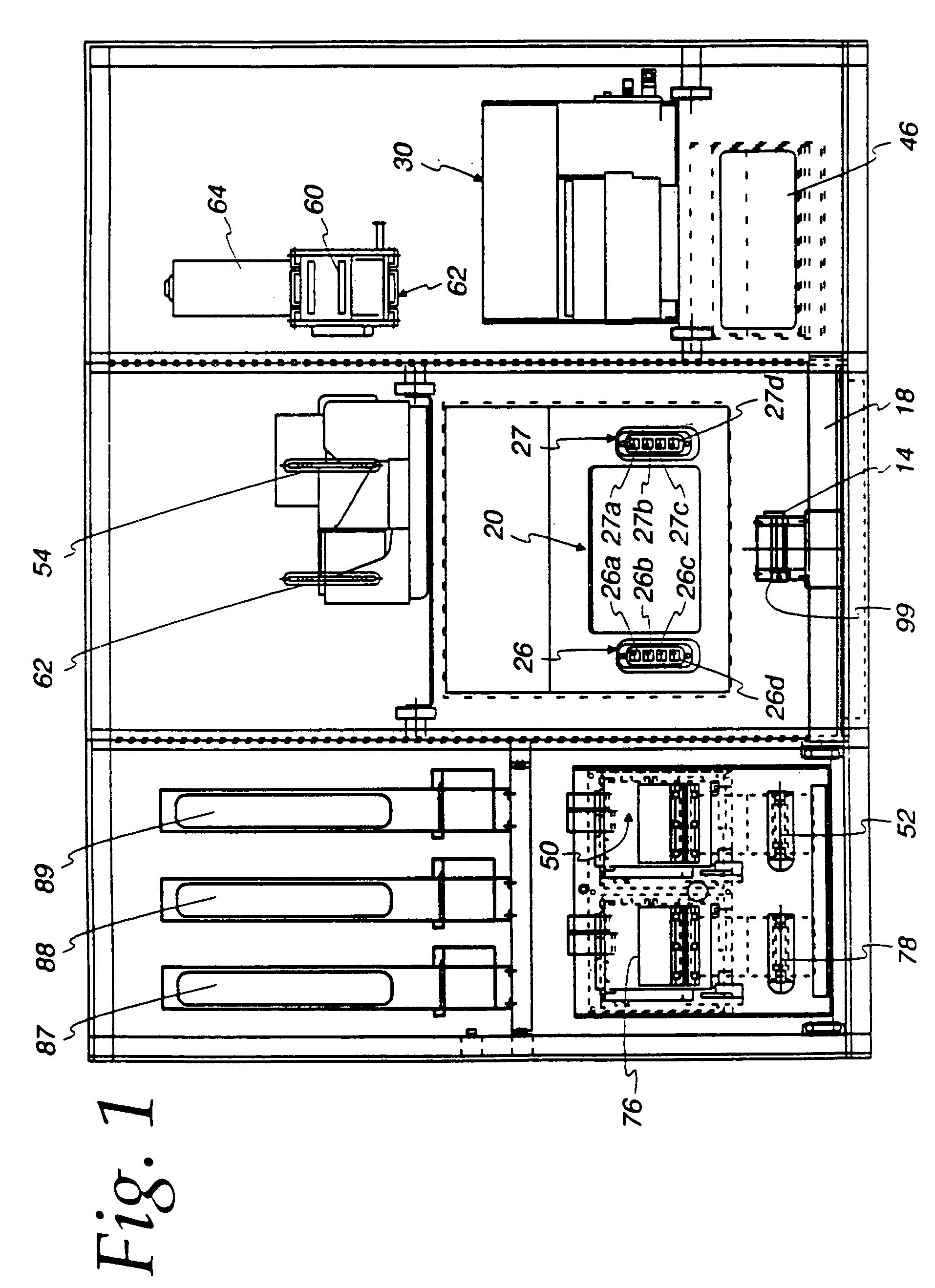

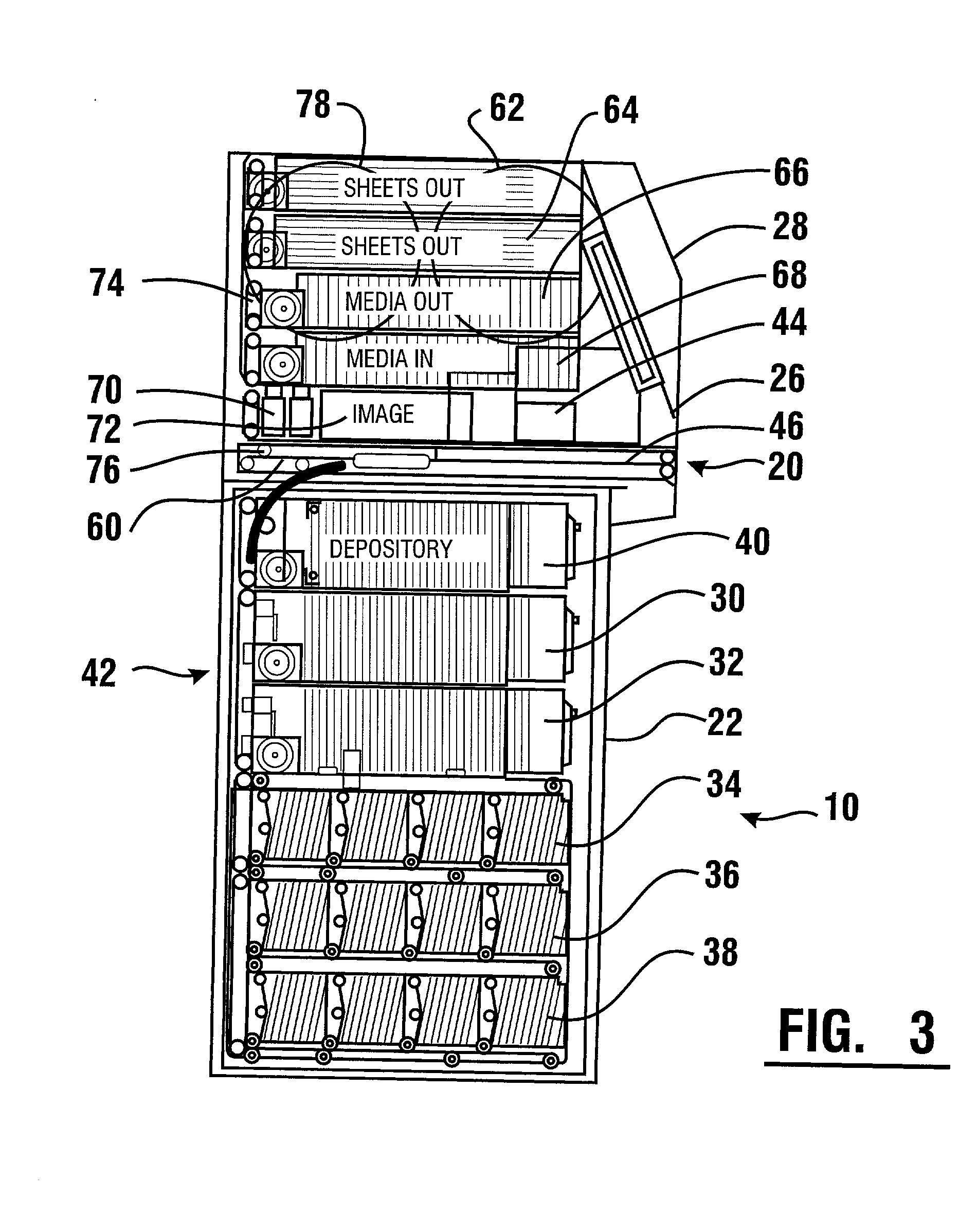

Automated document cashing system

InactiveUS7653600B2Magnification factor would decreaseAvoid zoom overshootComplete banking machinesFinanceCredit cardBank teller

An automated document cashing system is provided with an automated machine that cashes monetary transaction documents such as checks, money orders, and that makes deposit entries into the bank account of the user after validation of the user and monetary transaction document, without the aid of a bank teller. Validation of the identity of the user is performed with the use of a card associated with intelligence that identifies the user. A biometric device also may be used in identifying the validity of the user. Validation of the document involves one or more of: validating the presence of a signature; validating the amount of the monetary transaction document including a manual entry of the amount by the user; validating CAR against the LAR; and validating the banking system parameters and rules for the customer and / or the transaction. To assist in the automatic analysis of data on monetary transactional documents or on remittance documents, the user is prompted to provide a bounding box about the data. An image touch screen may be touched by the user to locate the bounding box and the user may magnify the data to fill the boundary box to exclude other data from this analysis. After document and person validation, the system will dispense money or transfer monies to a savings account, a checking account, a smart card, or the like. The system will also write money orders or wire transfer money. By supplying monies in the form of cash, credit card authorization, smart card balance, or the like to the machine, the user can pay bills such as a utility bill through the system or purchase items dispensed by the system.

Owner:UTILX CORP +2

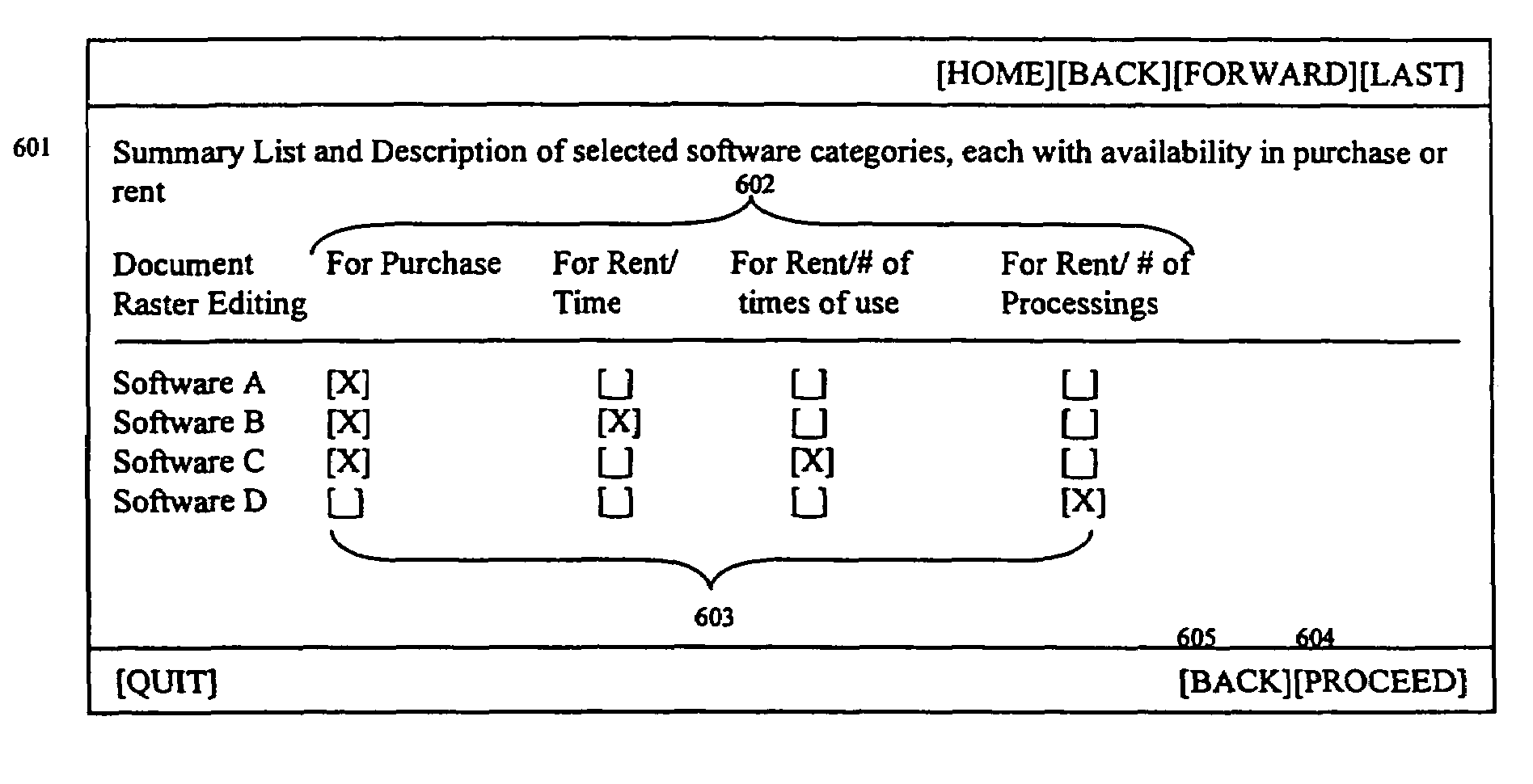

Method and apparatus for conducting electronic commerce transactions using electronic tokens

InactiveUS7177838B1Minimal overheadFinanceApparatus for meter-controlled dispensingThird partyCredit card

Methods and apparatus for conducting electronic commerce using electronic tokens are described. The electronic tokens are issued and maintained by a vendor, who also provides products and services that can be purchased or rented using the electronic tokens. The electronic tokens may be purchased from the vendor either on-line, using a credit card, or off-line, using a check, money order, purchase order. Because the vendor is the issuer of the electronic tokens, there is no need for transactions to be handled by a third party, such as a bank or other organization. This reduces the overhead involved in conducting electronic commerce, and provides the vendor with a greater amount of control. Additionally, the vendor maintains total control over the price of the electronic tokens at any time. For vendors who offer software products for sale or rental, use of electronic tokens makes a variety of rental arrangements practical, including rental for short periods of time, for a specific number of uses, or for a specific number of processings.

Owner:AML IP LLC

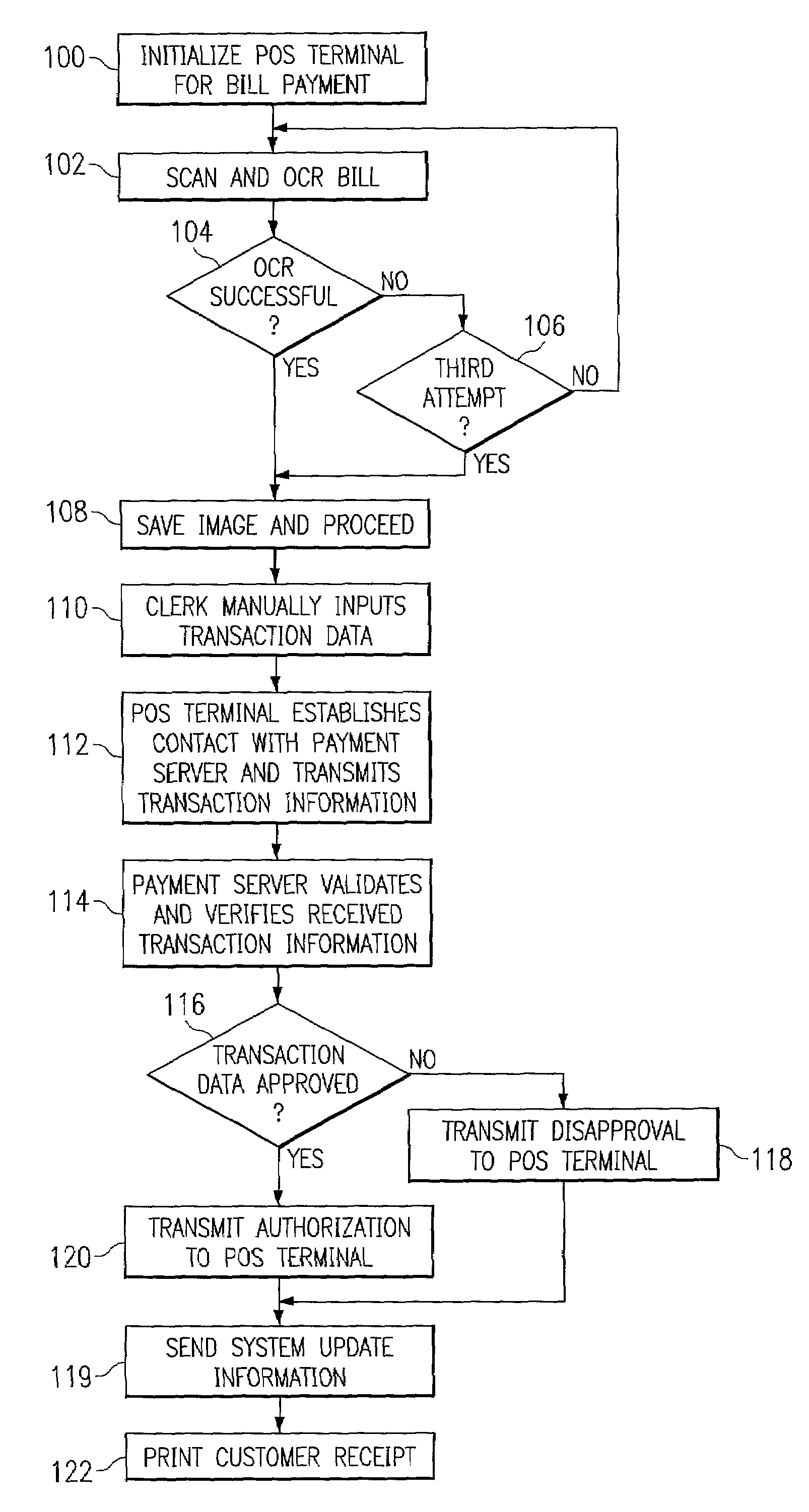

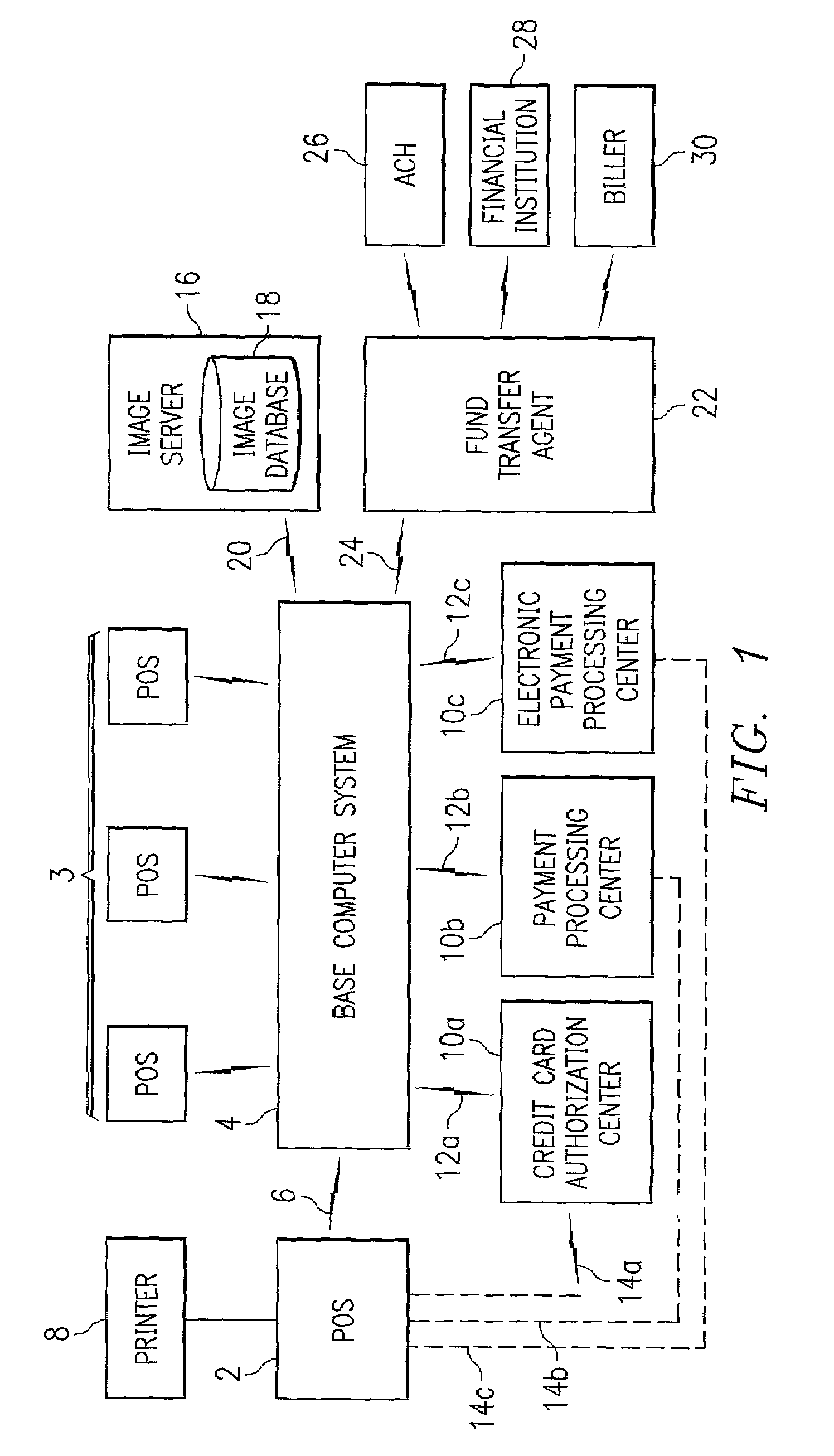

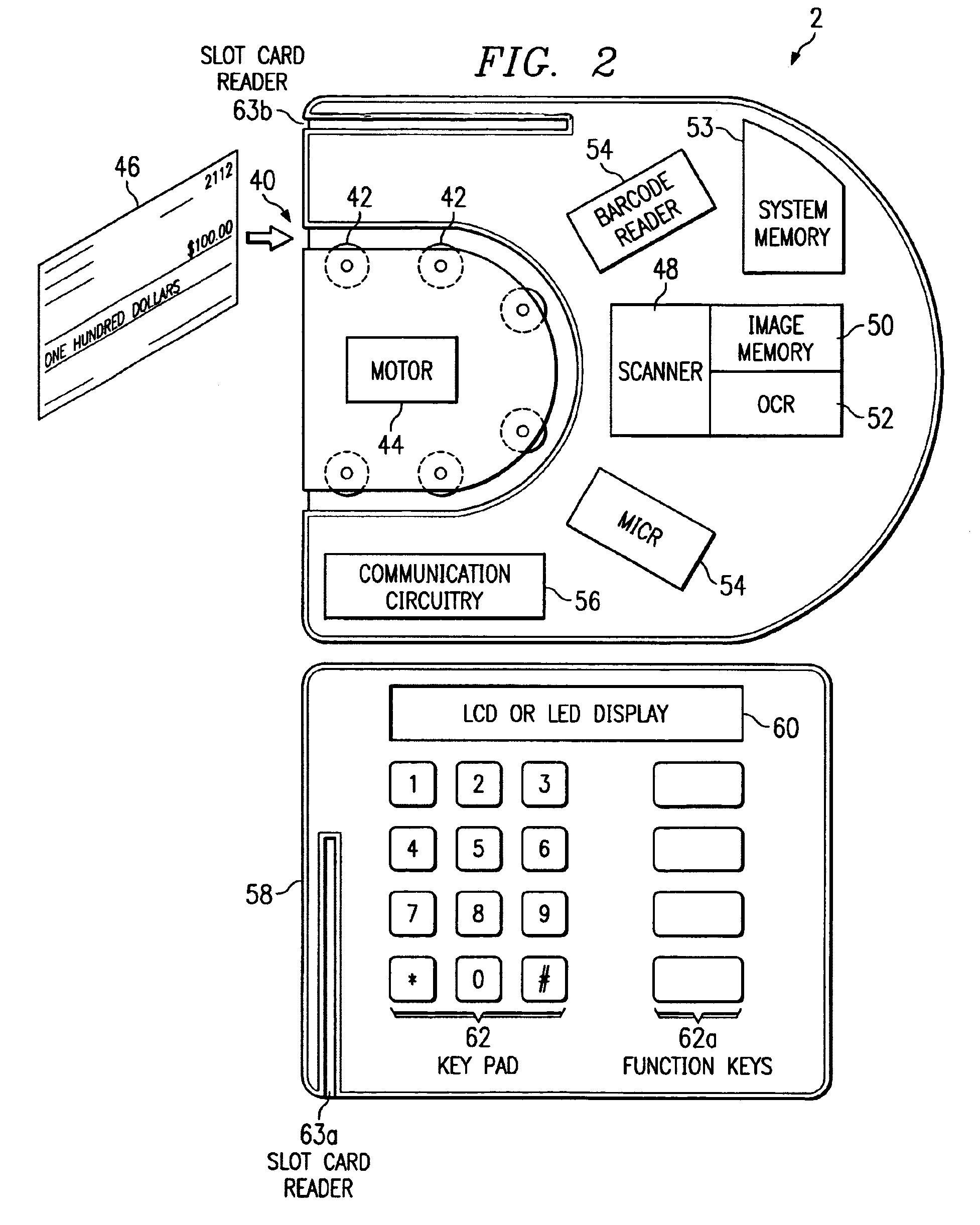

Method and apparatus for electronic commerce services at a point of sale

Point of sale transactions can be efficiently processed by use of a point of sale terminal having both image capture and storage capability, as well as other information input capabilities such as a MICR reader, a bar code reader, a keyboard, or similar input device. The system stores an image of the actual transaction documents, such as the bill to be paid and the check by which payment is made, for future reference and verification. In this way, paper copies of the bill need not be archived, and the check can be processed by electronic check conversion, further lowering costs. The electronic transaction information, such as biller identification, account number, payment made, and the like is forwarded from the POS location to a central data processing center in real time and authorization or denial of authorization to accept payment is returned to the POS terminal in real time. Additionally, system updates such as authorized billers, service fee schedules, and the like can be updated in real time, each time a transaction is transmitted from or to the POS terminal. Another advantageous feature is that a single POS terminal can be configured to communicate with multiple service providers and hence accommodate multiple different types of transactions such as issuing money orders, gift certificates, official checks, payroll checks, check cashing, bill paying, credit card authorization, age verification, and the like.

Owner:GSC ENTERPRISES

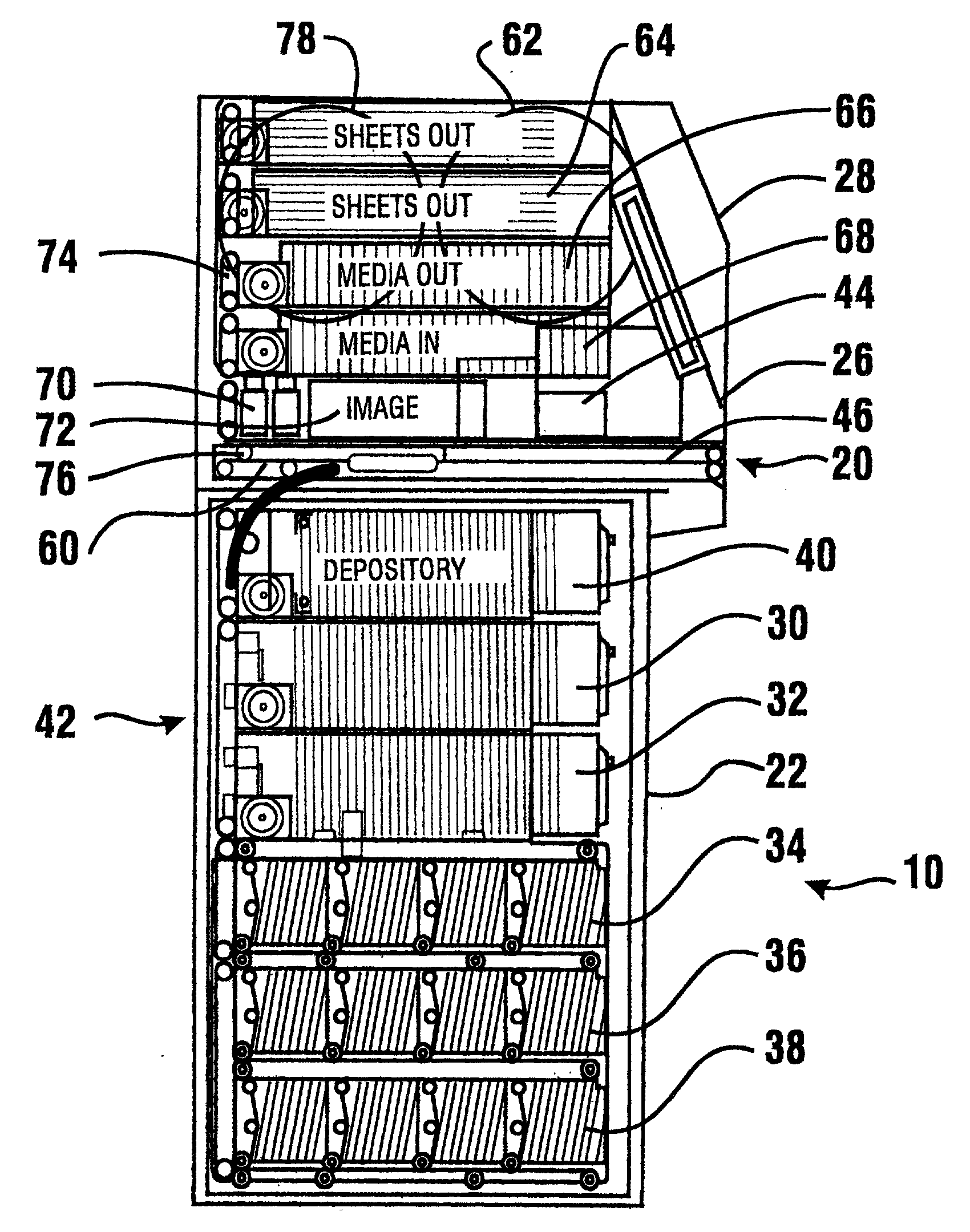

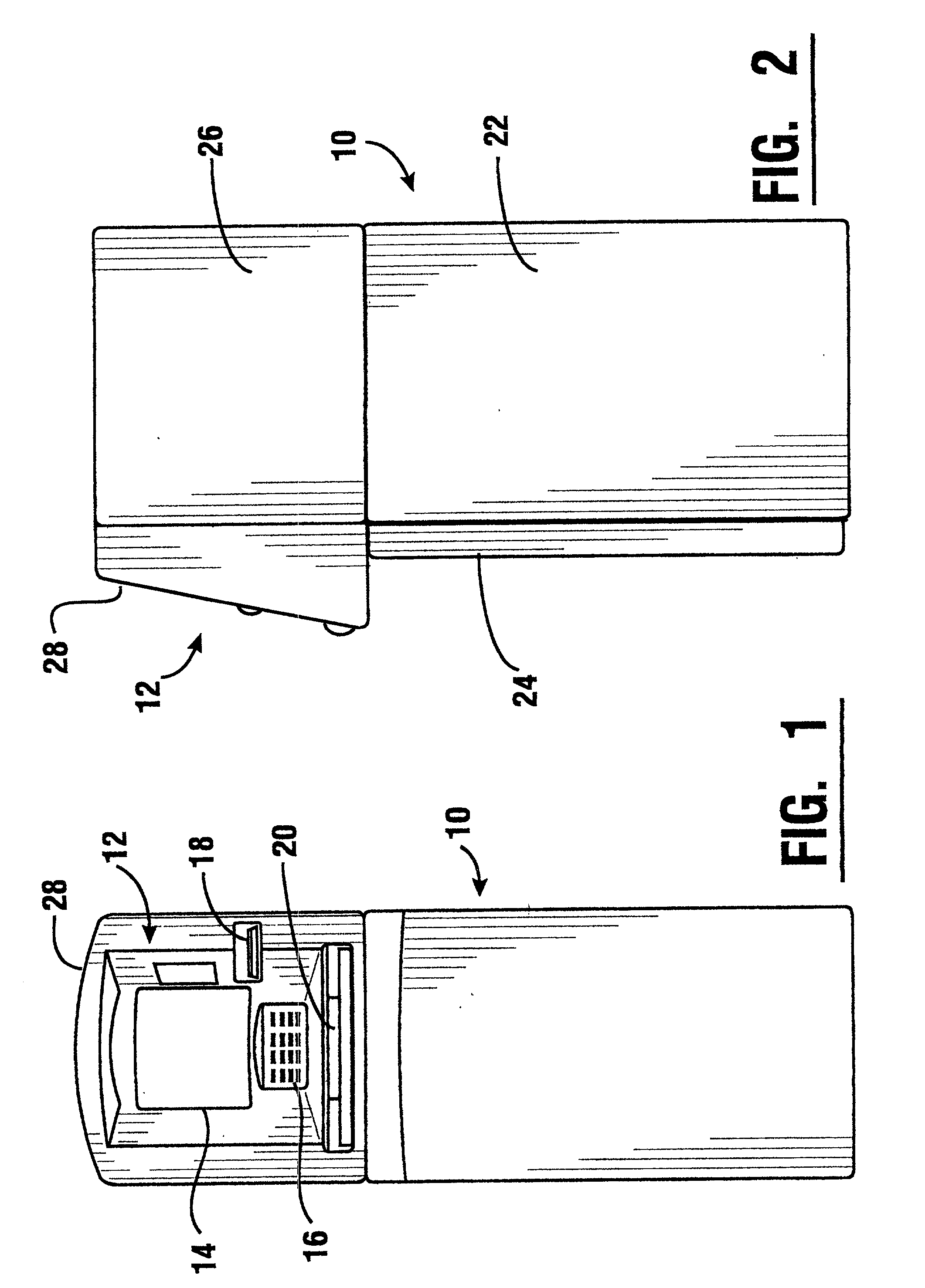

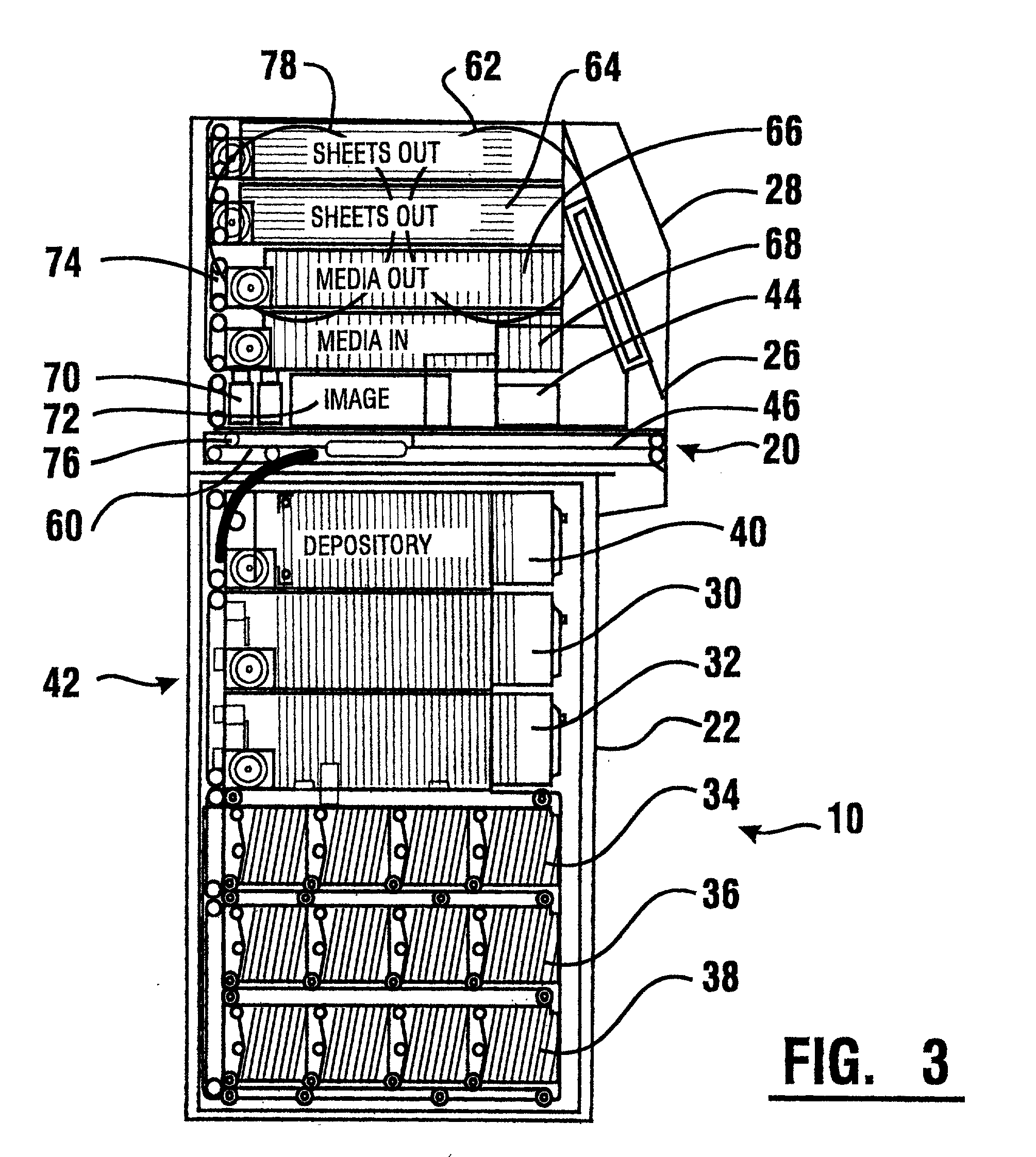

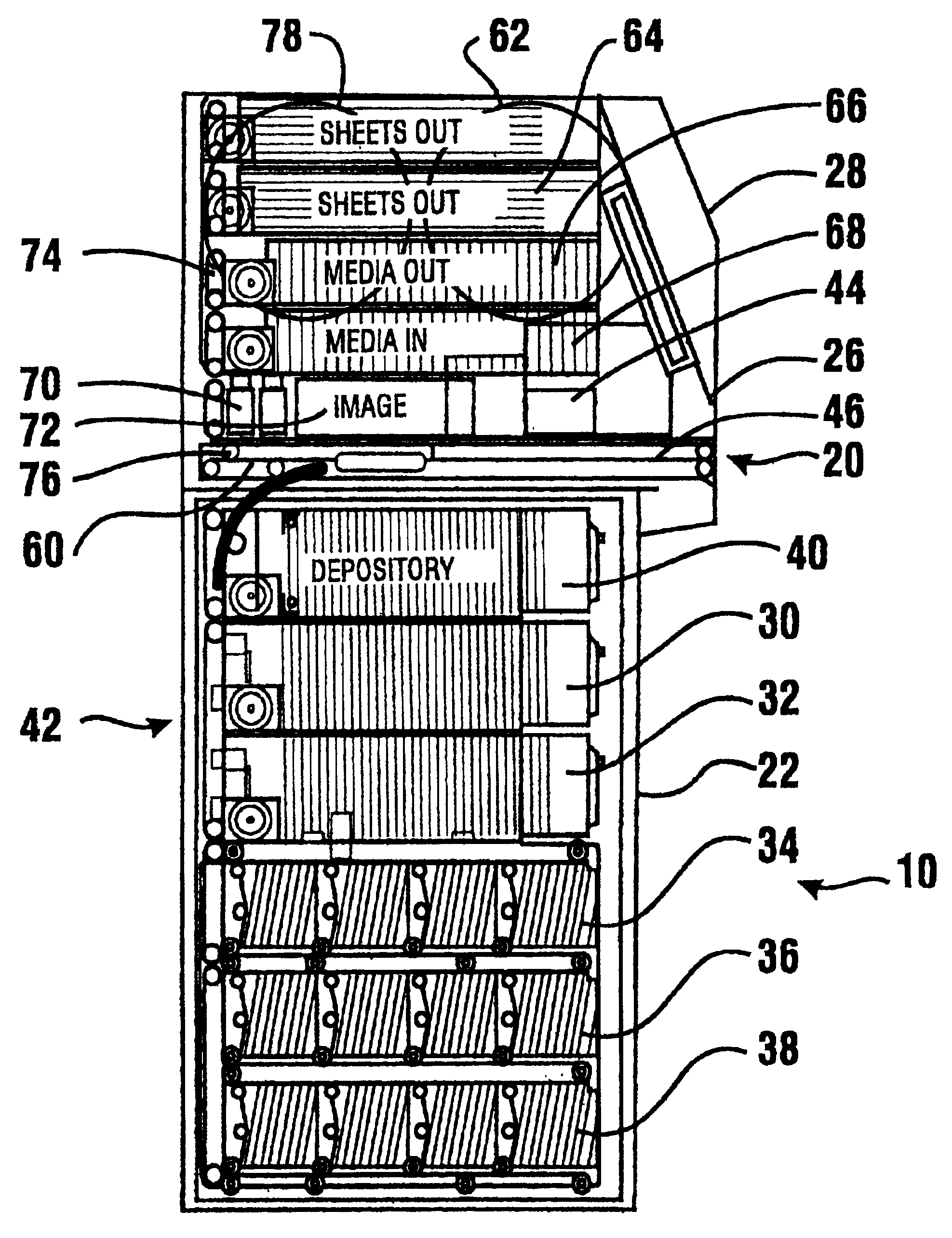

Automated banking machine currency tracking system

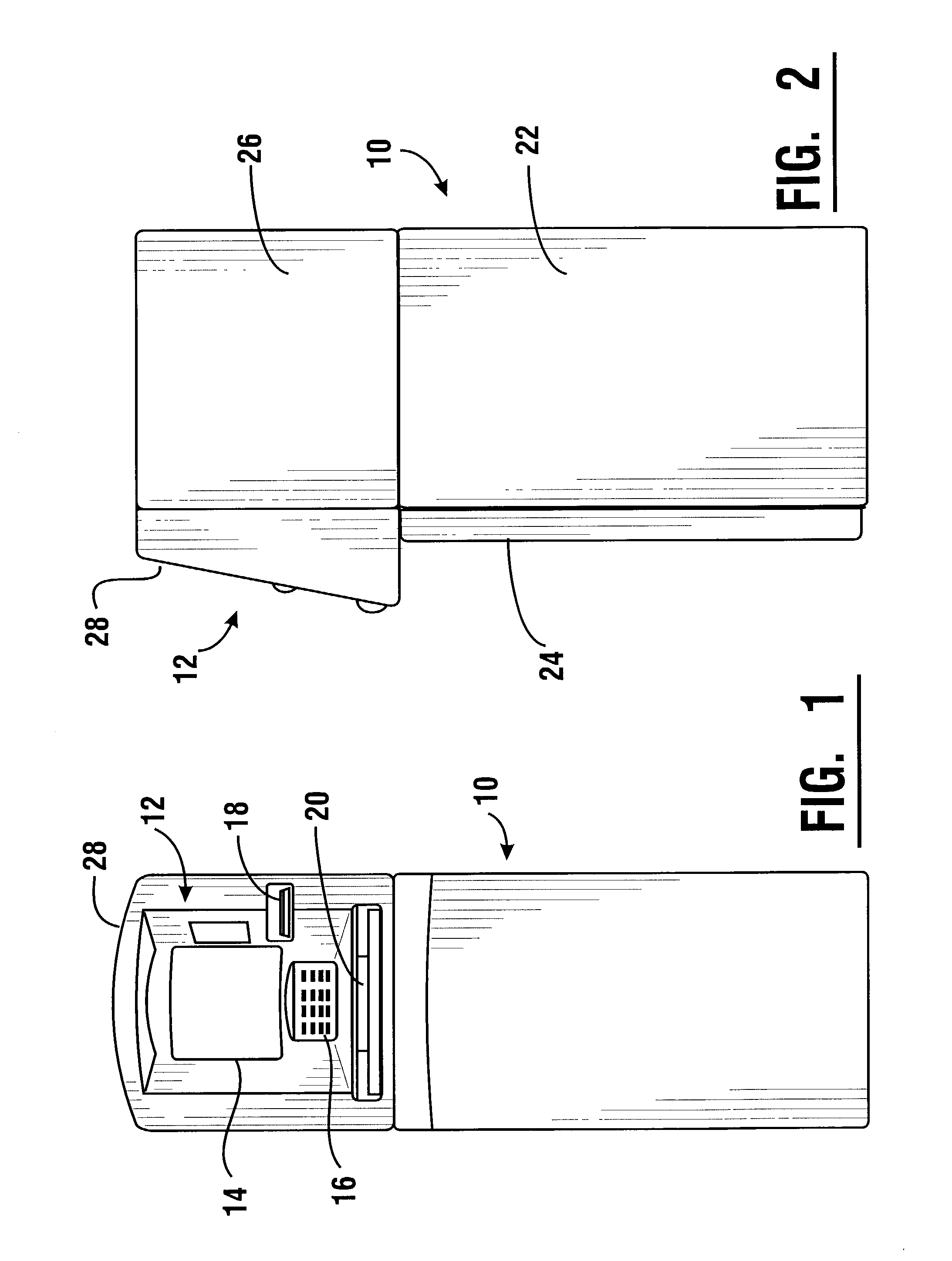

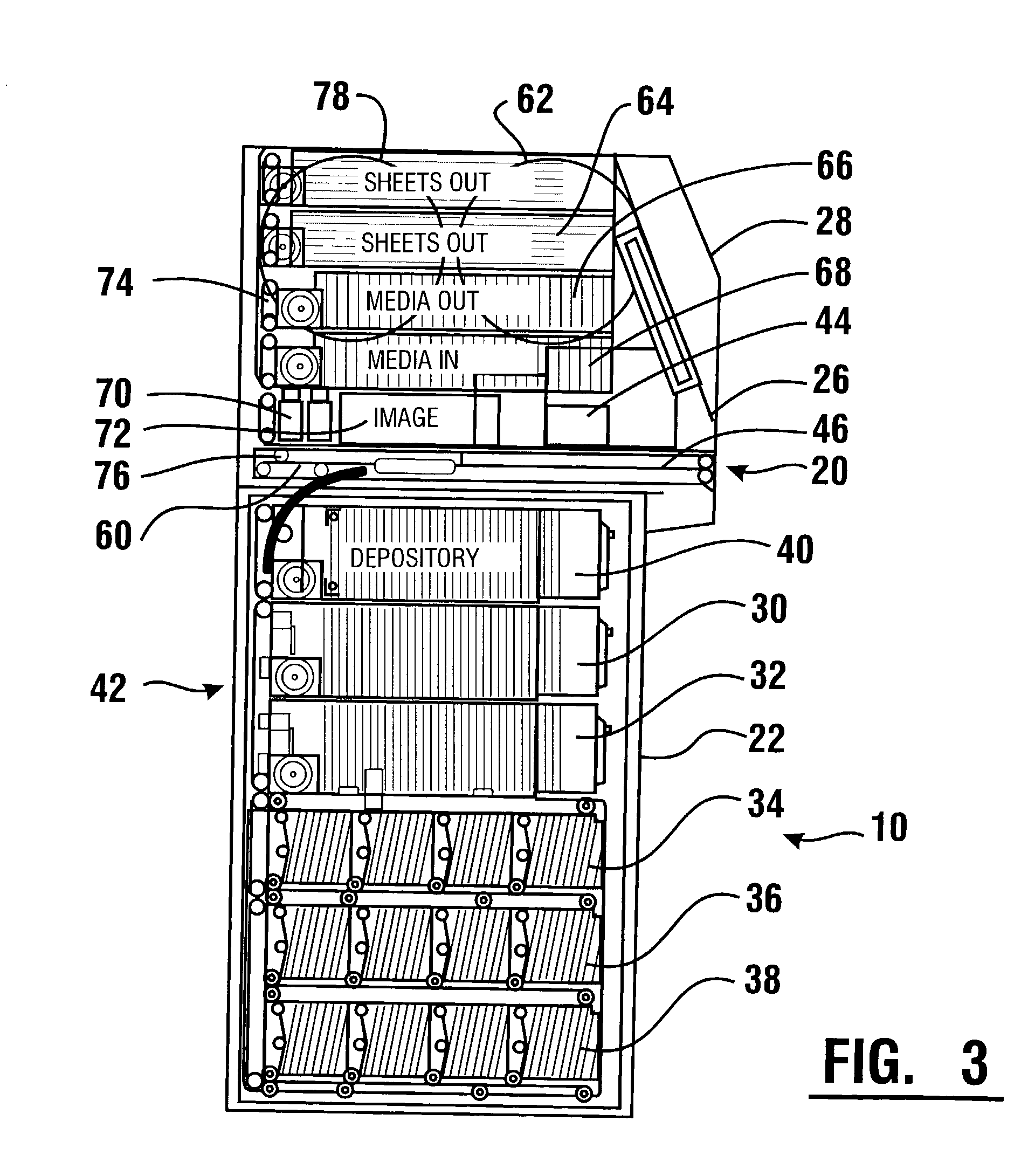

InactiveUS7028888B2Simpler customer interfaceOptimizationComplete banking machinesFinanceChequeEngineering

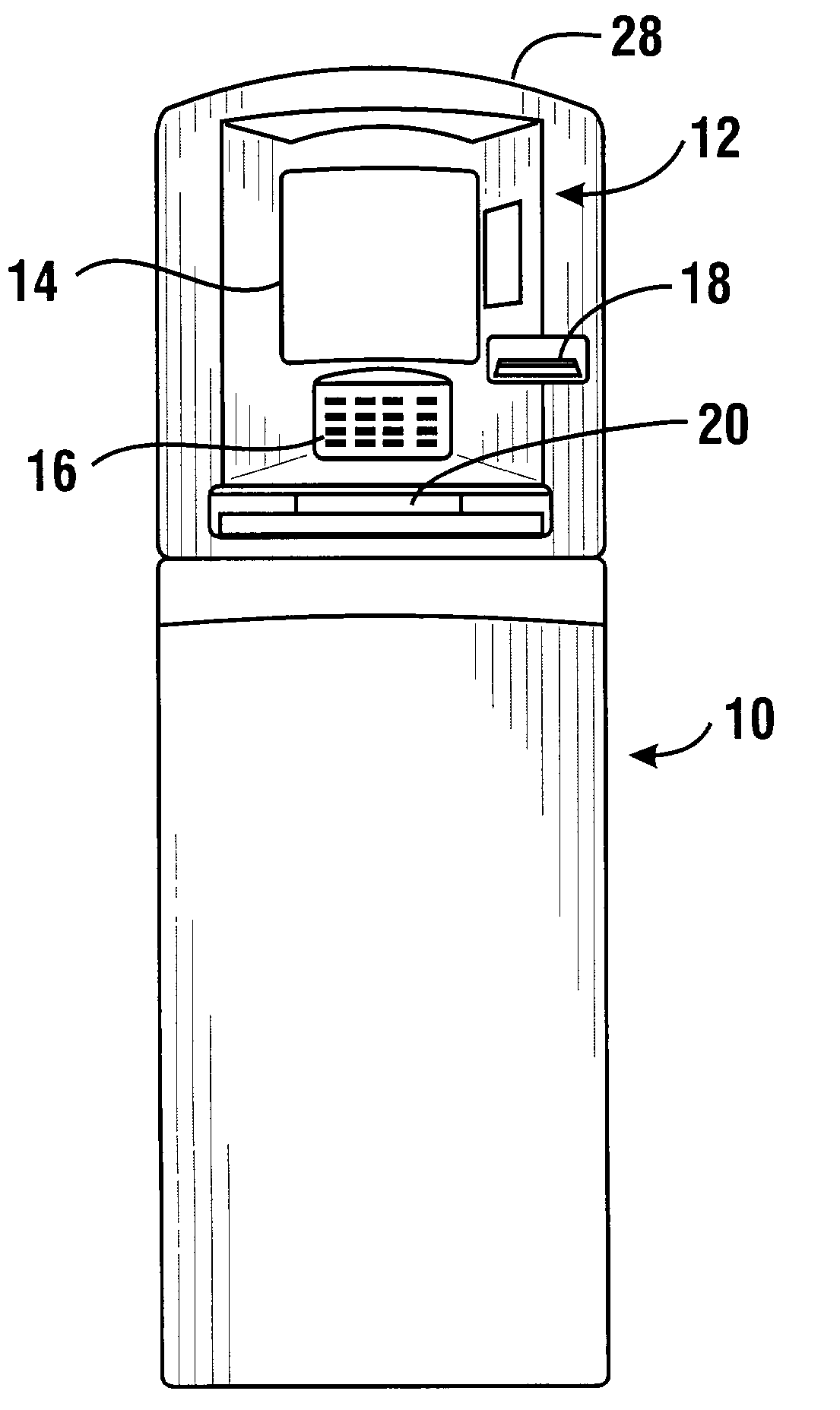

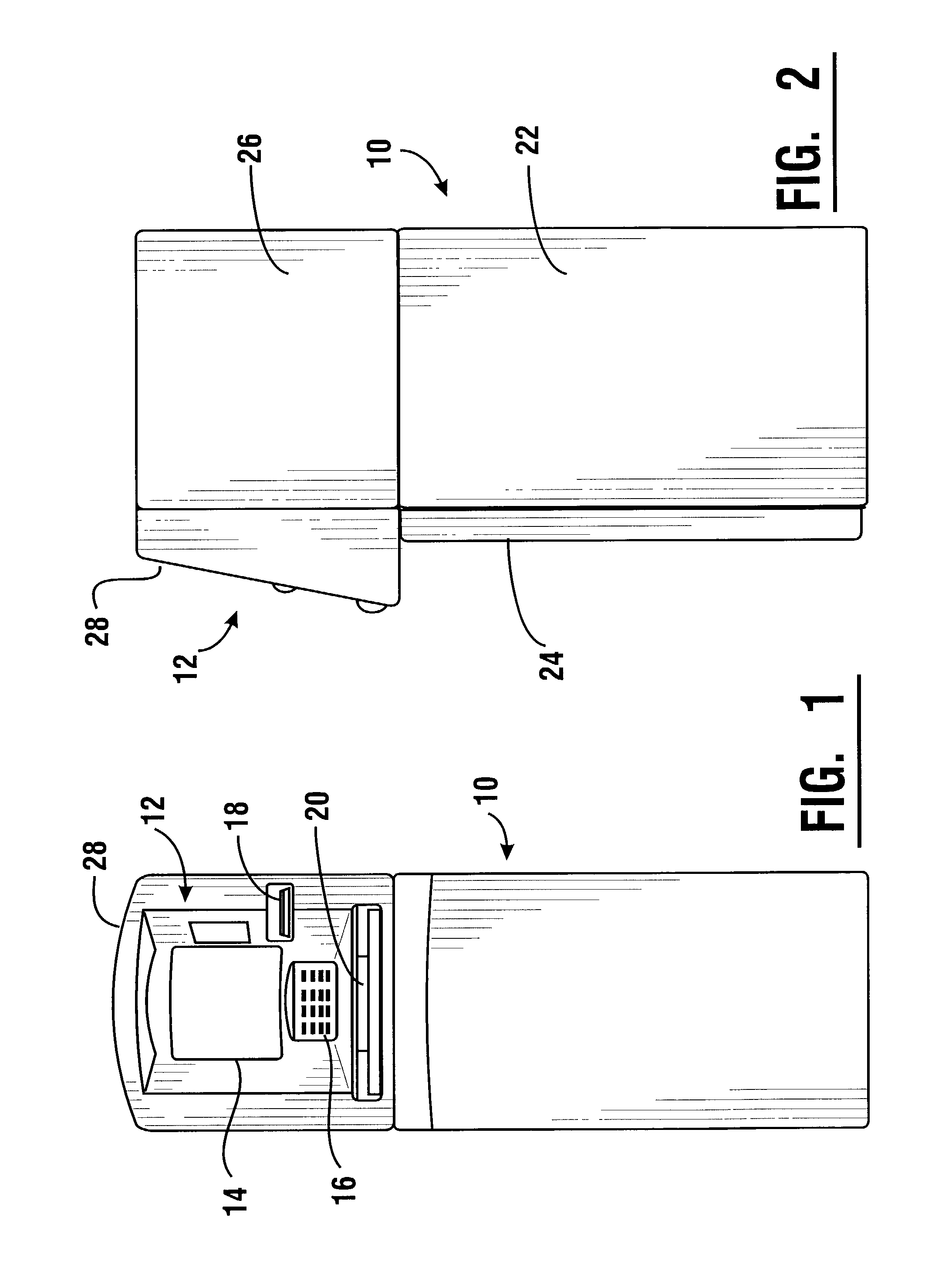

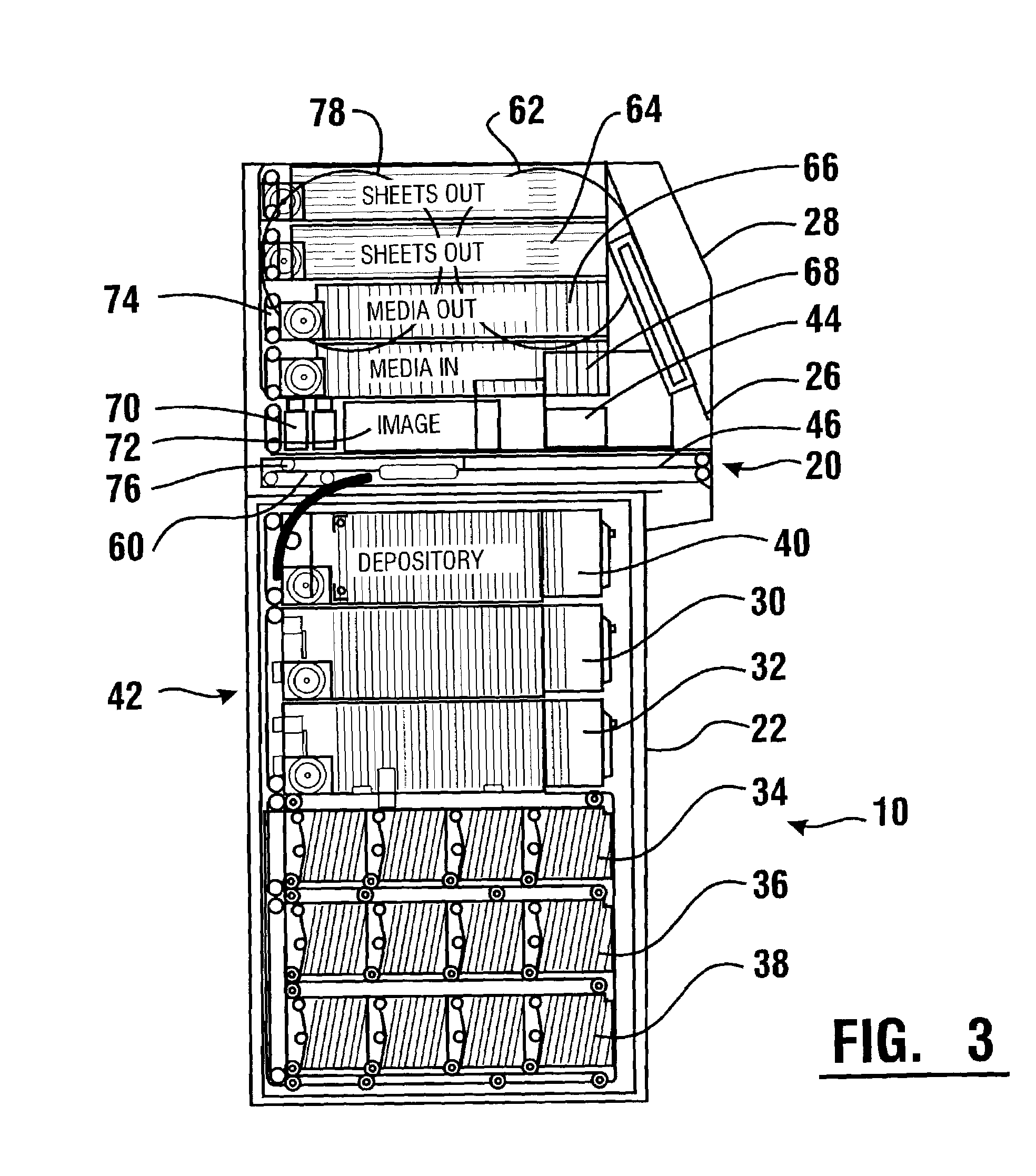

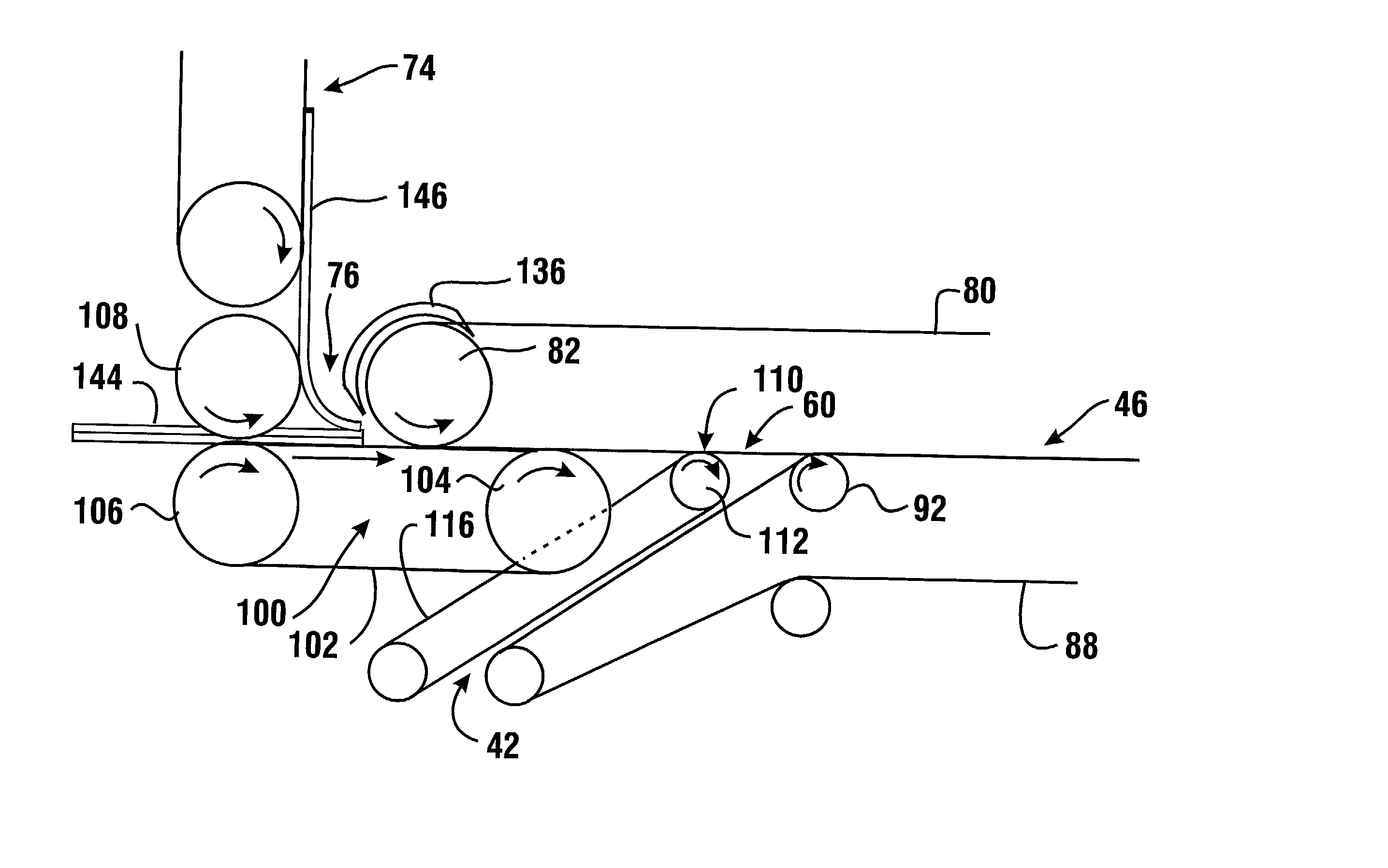

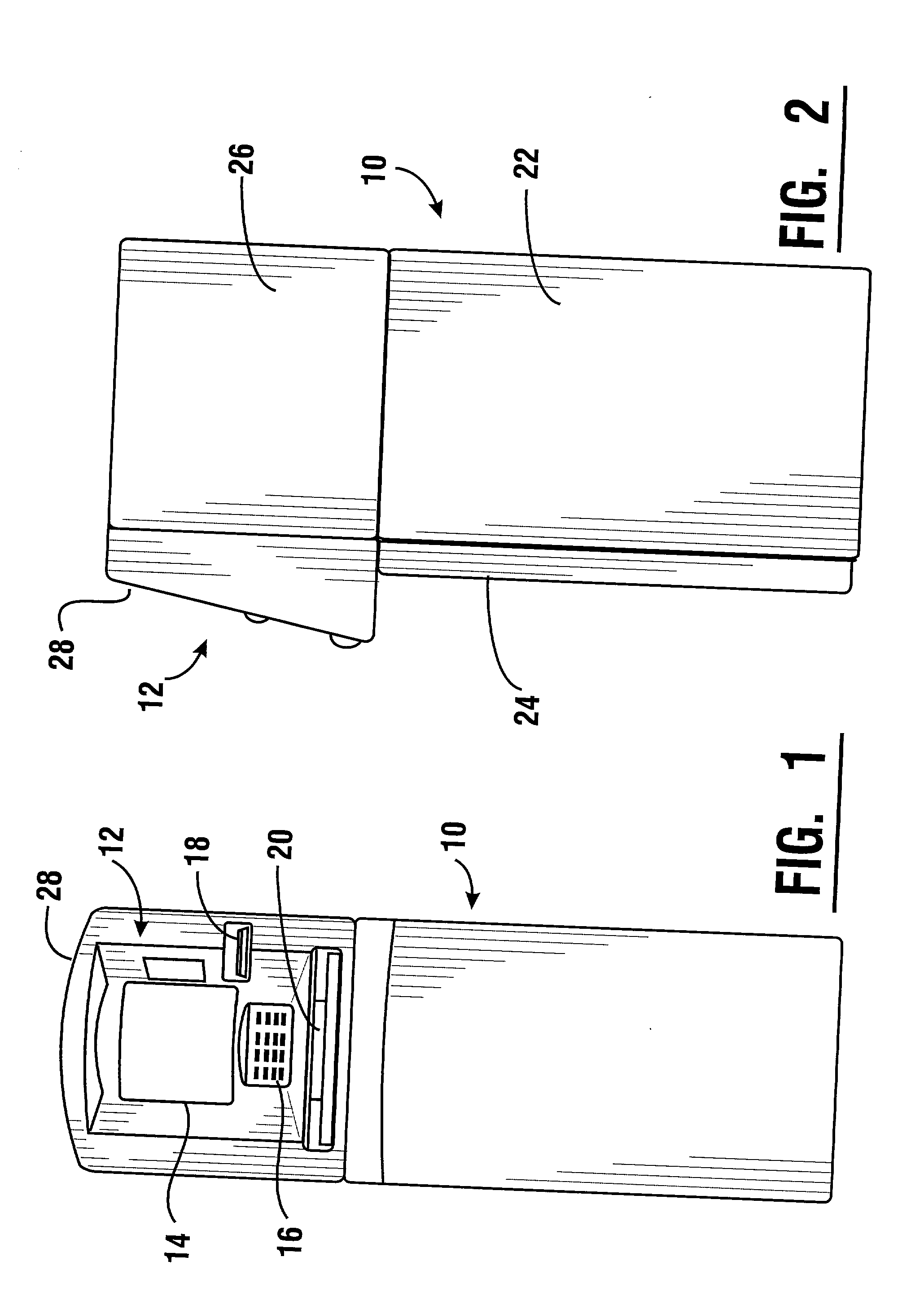

An automated banking machine (10) includes a user interface (12) including an opening (20). Users of the machine deliver and receive individual sheets and stacks of sheets to and from the machine through the opening. Stacks of sheets may include sheets such as notes, checks or other documents. Stacks input to the machine may include mixtures of various types of sheets. The machine operates to receive notes, process checks and perform other operations. Notes received in the machine and assessed as valid may be recycled and dispensed to other users. Notes assessed by the machine as being of questionable validity may be marked with a removable mark and subjected to further analysis. Checks processed by the machine may be imaged by an imaging device, cancelled and stored in the machine or alternatively returned to a user. Documents produced by the machine such as receipts, checks or money orders as well as notes dispensed from the machine may be assembled into a stack within the machine and delivered from the machine through the opening.

Owner:DIEBOLD NIXDORF

Automated banking machine currency tracking method

ActiveUS20030116478A1Simpler customer interfaceOptimizationComplete banking machinesFinanceChequeEngineering

An automated banking machine (10) includes a user interface (12) including an opening (20). Users of the machine deliver and receive individual sheets and stacks of sheets to and from the machine through the opening. Stacks of sheets may include sheets such as notes, checks or other documents. Stacks input to the machine may include mixtures of various types of sheets. The machine operates to receive notes, process checks and perform other operations. Notes received in the machine and assessed as valid may be recycled and dispensed to other users. Notes assessed by the machine as being of questionable validity may be marked with a removable mark and subjected to further analysis. Checks processed by the machine may be imaged by an imaging device, cancelled and stored in the machine or alternatively returned to a user. Documents produced by the machine such as receipts, checks or money orders as well as notes dispensed from the machine may be assembled into a stack within the machine and delivered from the machine through the opening.

Owner:DIEBOLD NIXDORF

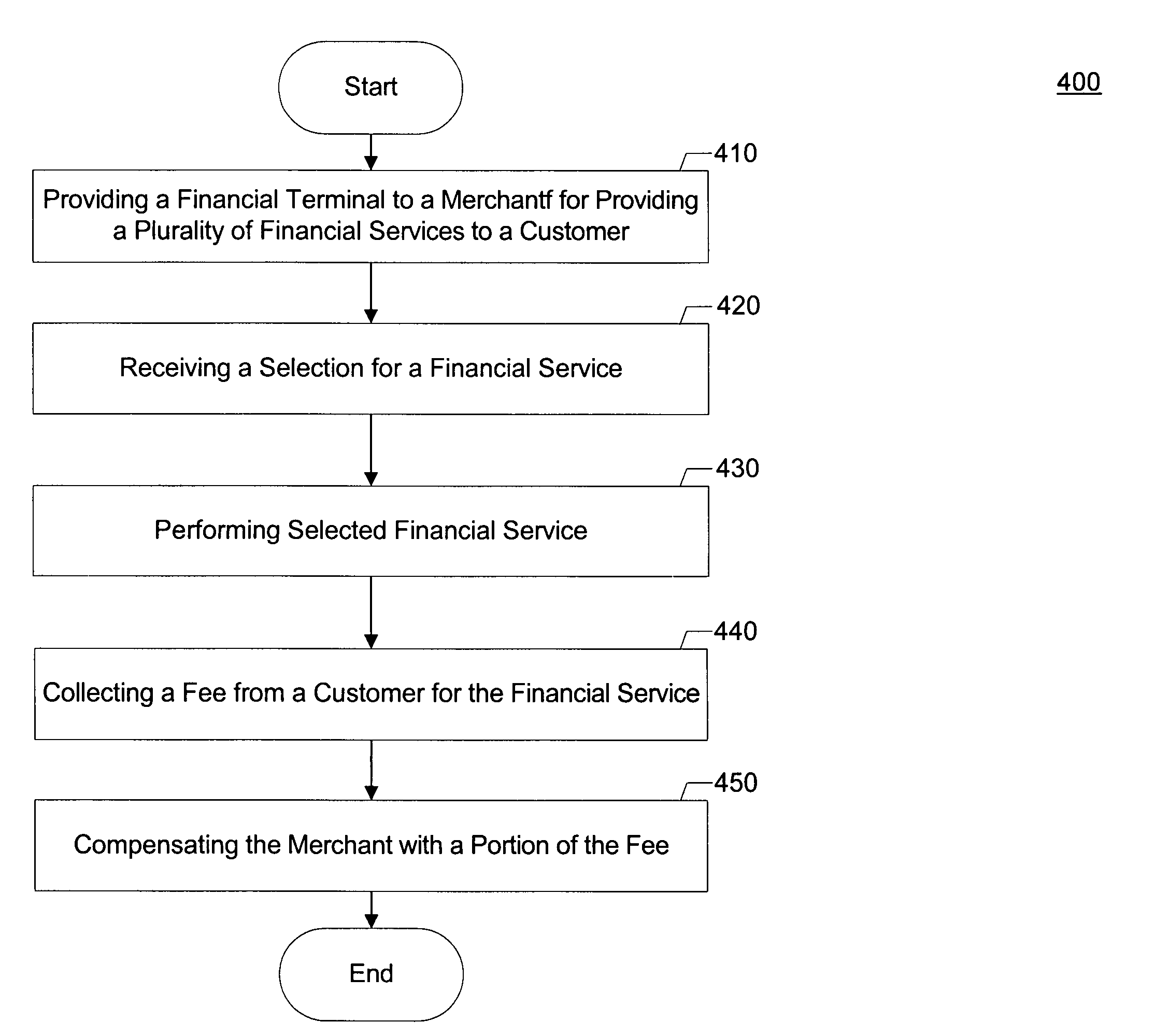

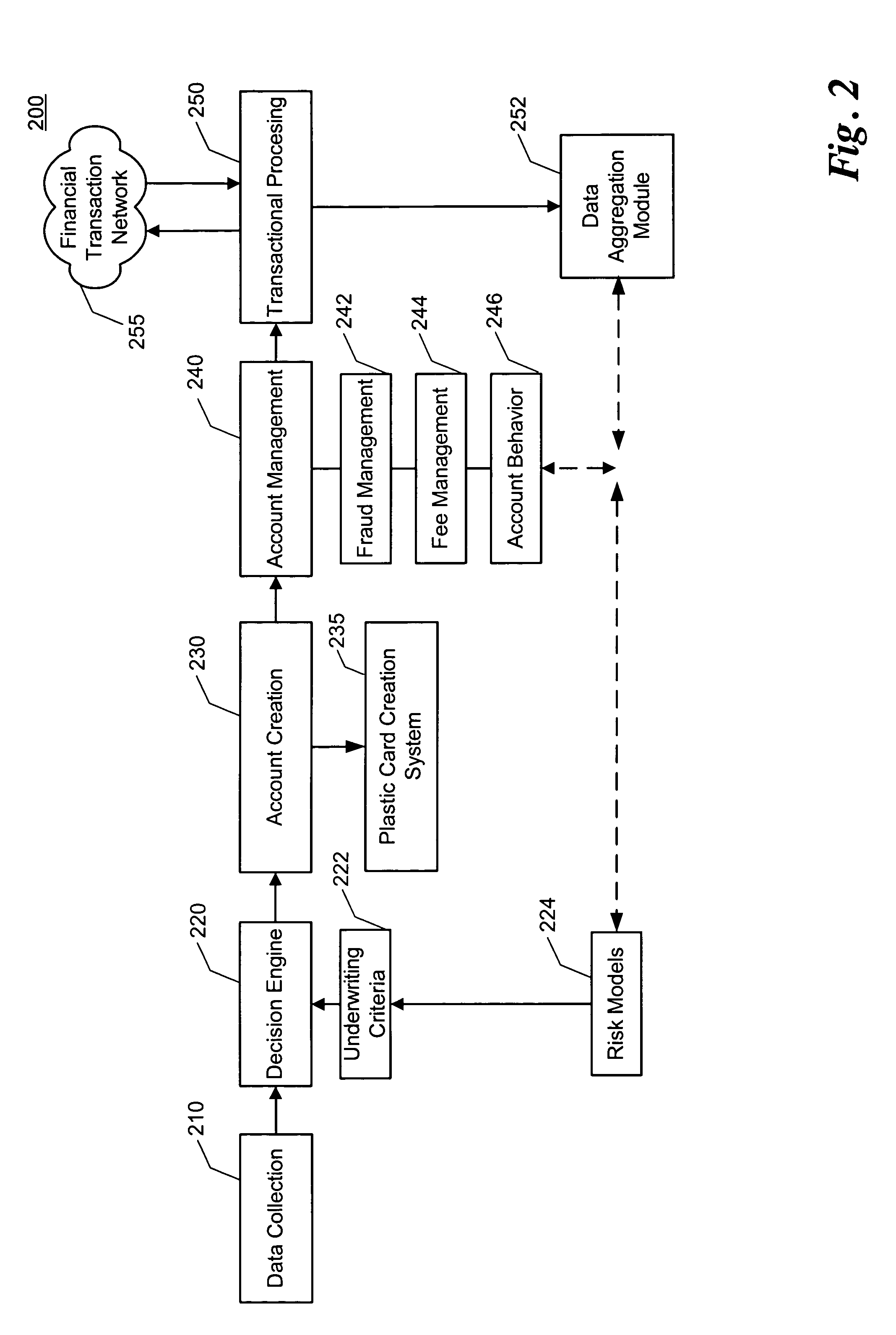

System, method and apparatus for providing financial services

The present invention is a system, method and apparatus for a terminal capable of accepting debit / credit or ATM cards, checks, money orders, cashiers checks, travelers checks, as well as a drivers license, state identification card, birth certificate and additionally any type of information that may be inputted into the terminal such as, but not limited to, an individuals direct deposit account (DDA) number, savings account number, etc. to facilitate a purchase, transfer of funds, wire of funds, cash-back option, etc. at a merchant location. In addition, the present invention will allow an individual to purchase pre-paid credit-type cards, pre-paid telecom cards, stamps, etc. at the terminal.

Owner:COMPUCREDIT INTPROP HLDG CORP II

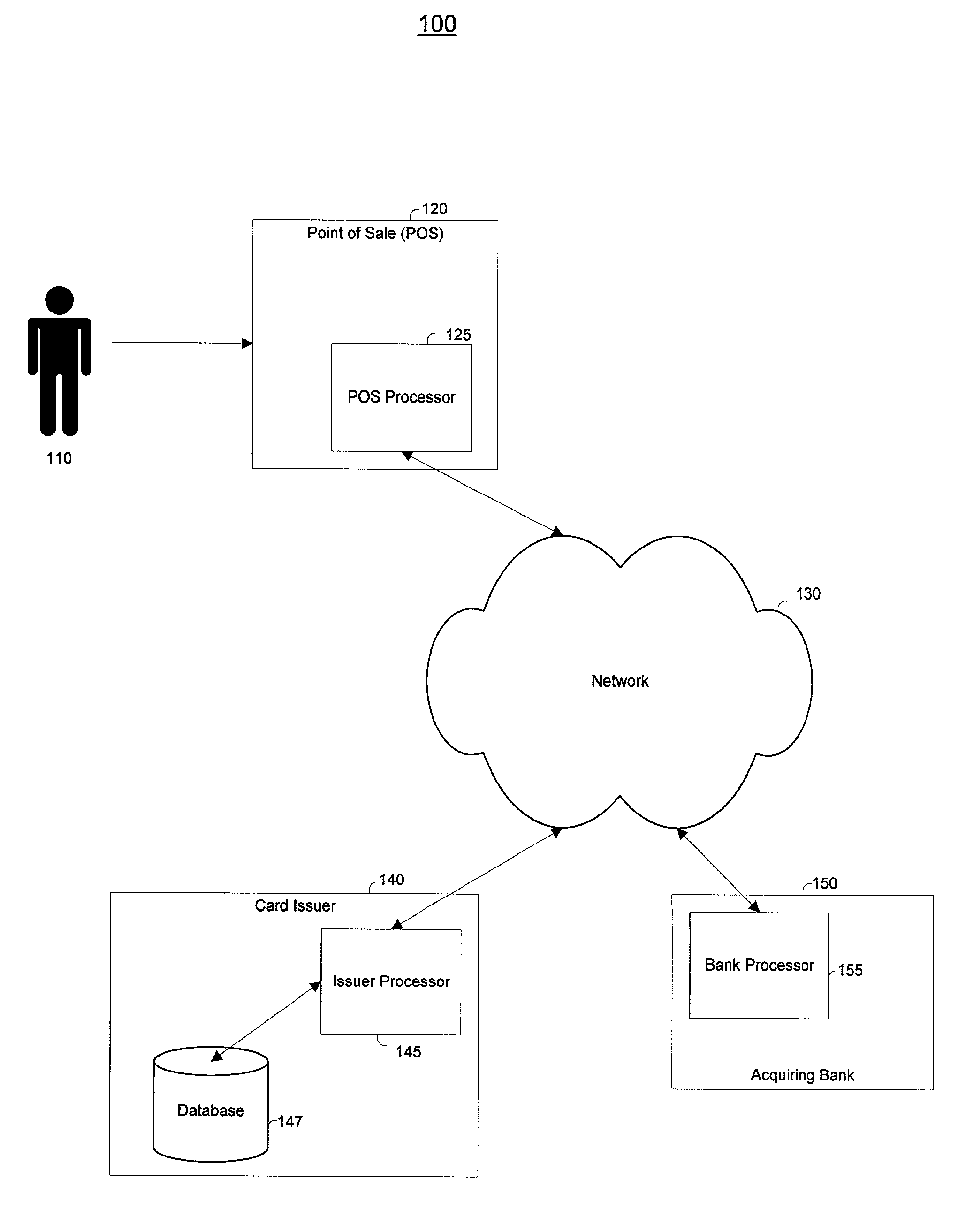

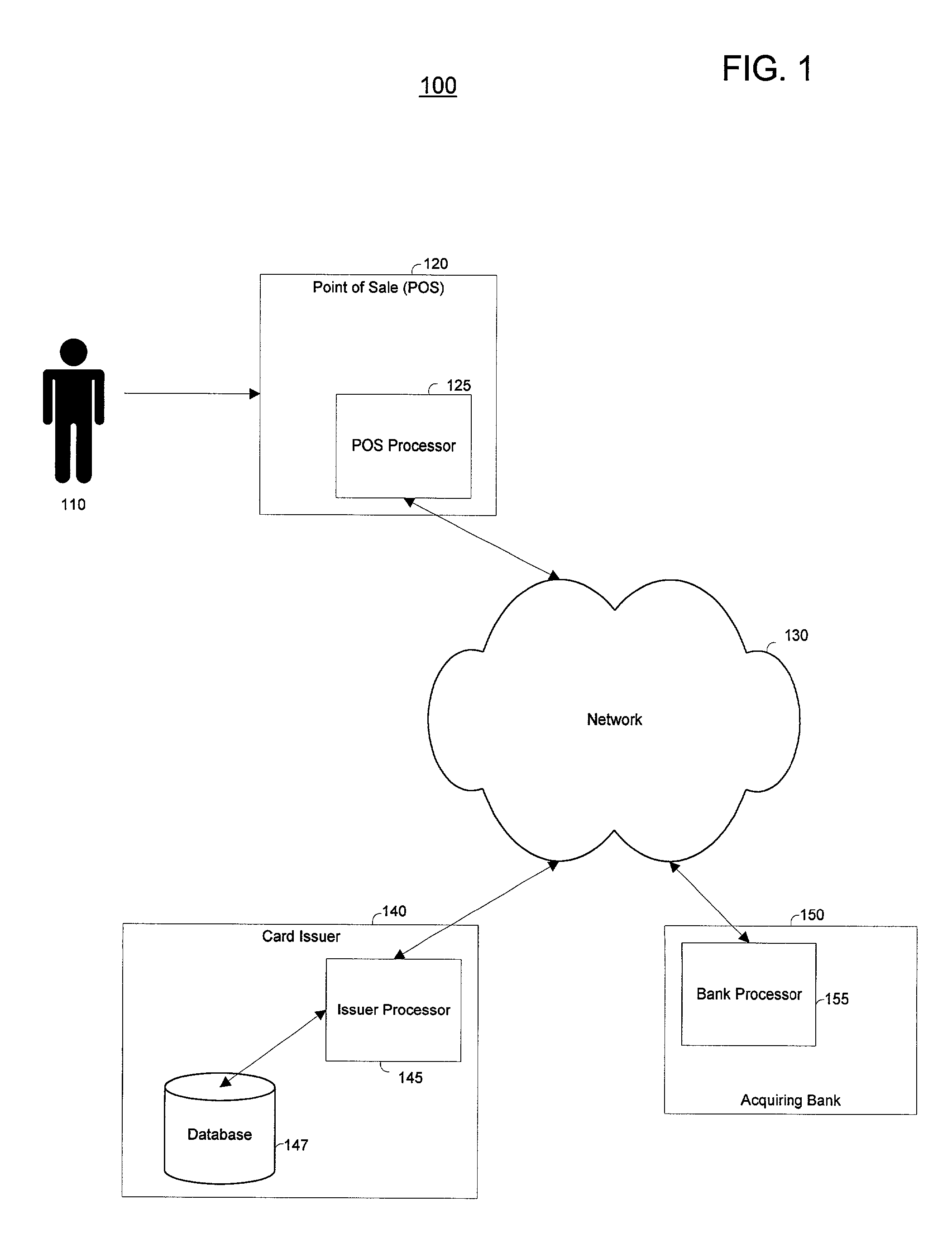

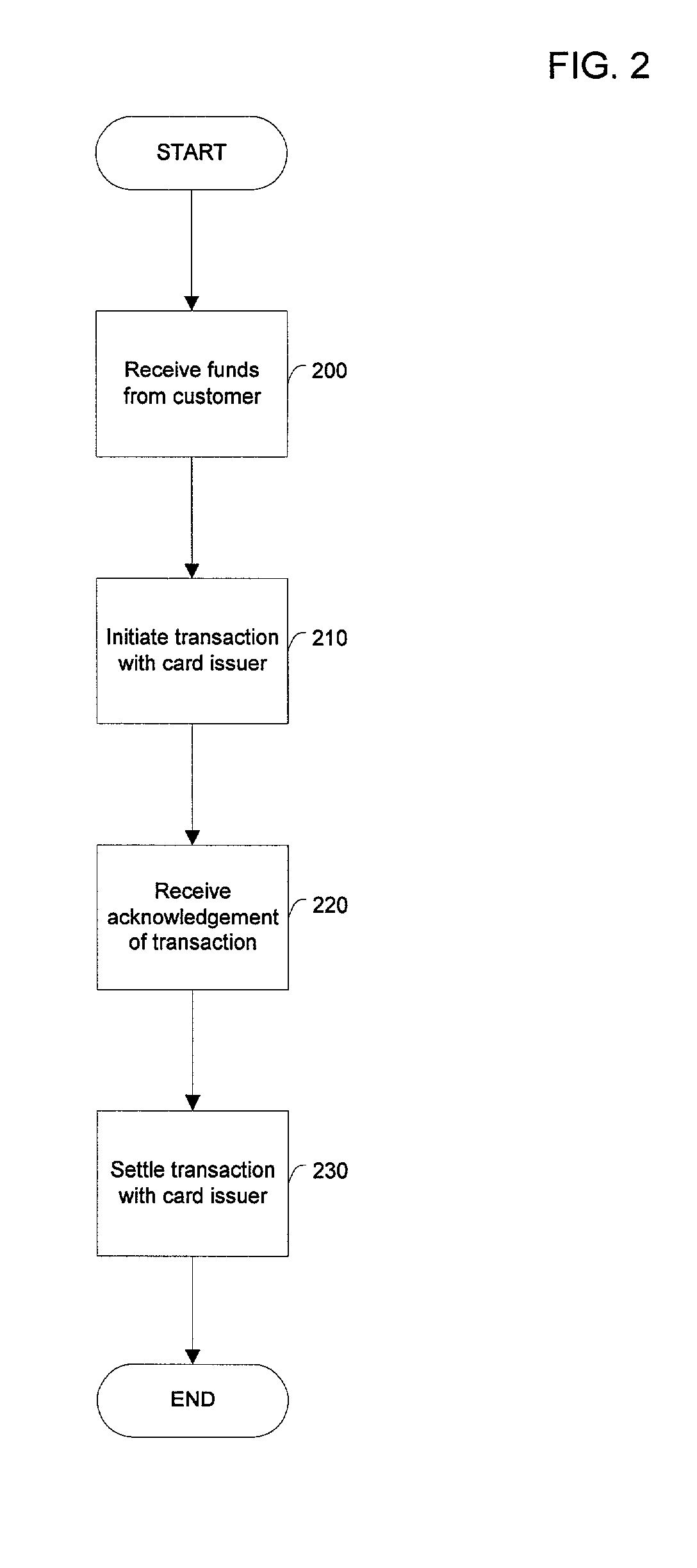

Methods and systems for remote point-of-sale funds transfer

Systems and methods consistent with the principles of the present invention address the need to more conveniently and efficiently transfer value to a card issuer. Specifically, in systems and methods consistent with the invention, funds to be applied as a payment to an account are received at a point-of-sale location from a cardholder. These funds may include cash, check, credit card, money order, cashier's check, or other cash equivalent. A transaction message, indicating a payment transaction and a payment amount, is sent from the point-of-sale location to the card issuer. The card issuer then verifies the account information indicated in the transaction message. When the point-of-sale location then receives an indication that the payment amount was applied to the account, the point-of-sale location forwards the payment to the card issuer.

Owner:CAPITAL ONE FINANCIAL

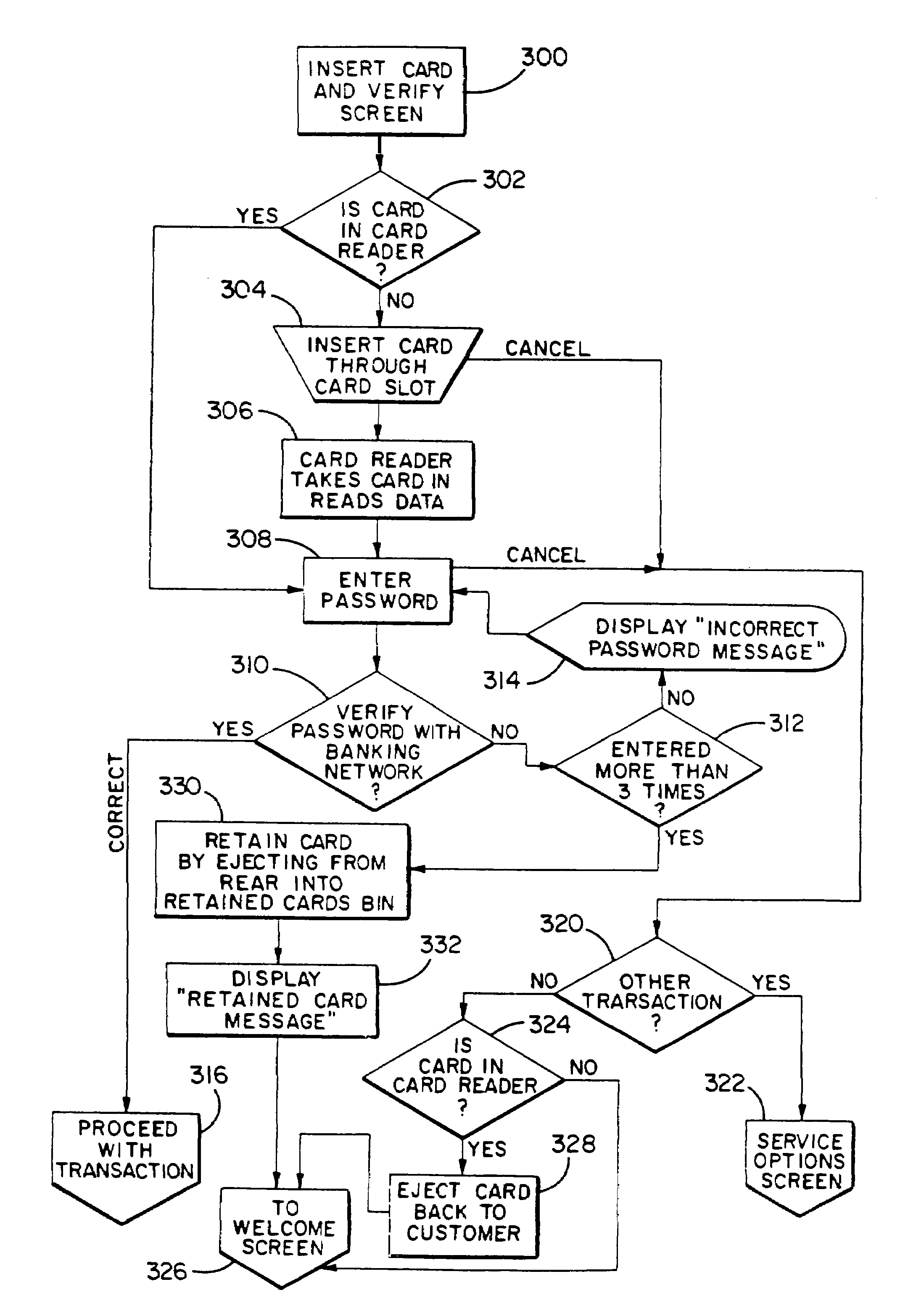

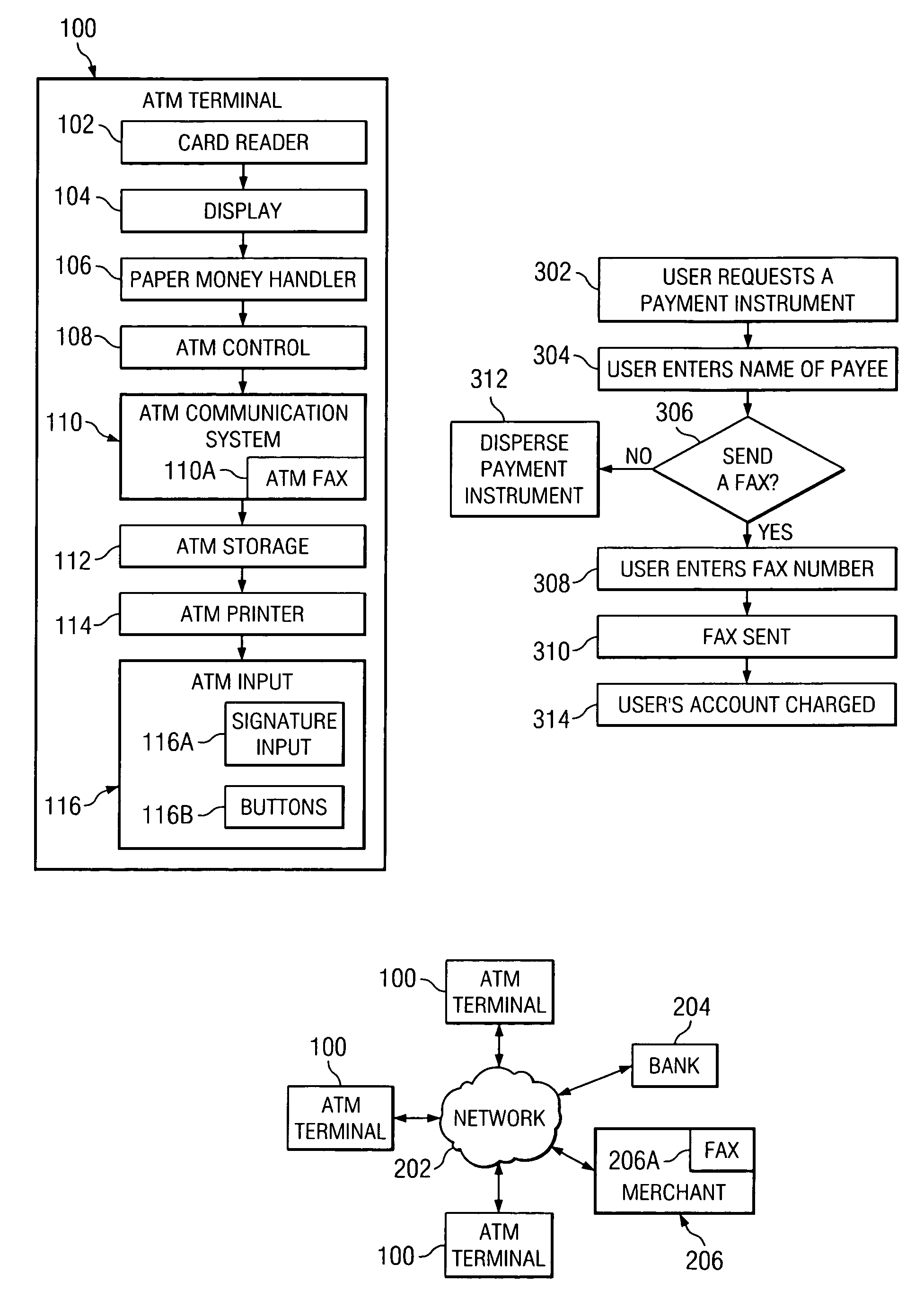

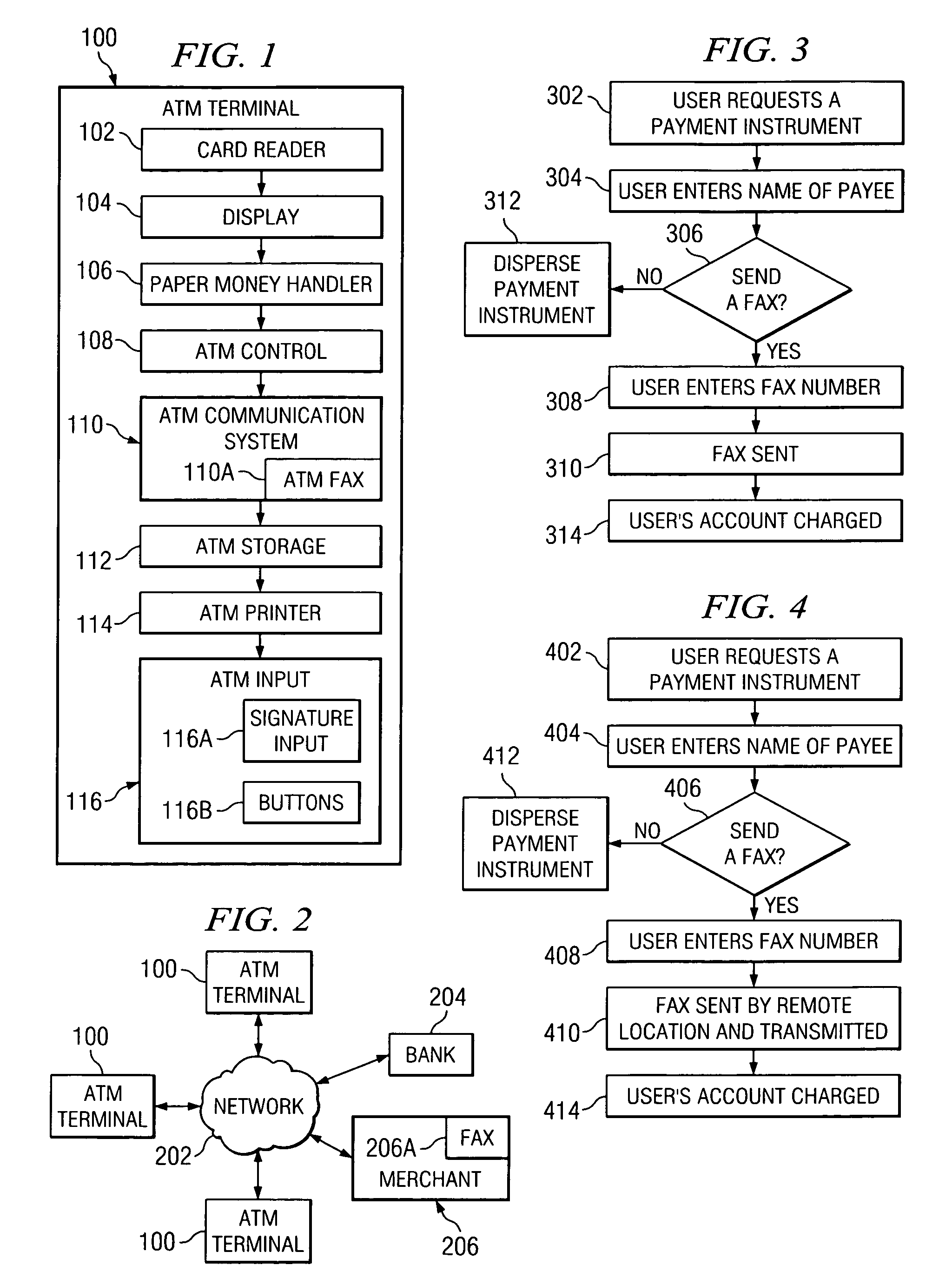

Fax check/money order automatically from ATM

An automatic teller machine capable of sending a facsimile of a check, money order, or other payment instrument to a payee designated by a user. The user inserts cash or allows an account to be debited to pay for the payment instrument, and the automatic teller machine faxes the payment instrument to the payee.

Owner:GOOGLE LLC

Method and apparatus for conducting electronic commerce transactions using electronic tokens

InactiveUS7376621B1Accurate recordInhibit transferComplete banking machinesFinanceThird partyCredit card

Methods and apparatus for conducting electronic commerce using electronic tokens are described. The electronic tokens are issued and maintained by a vendor, who also provides products and services that can be purchased or rented using the electronic tokens. The electronic tokens may be purchased from the vendor either on-line, using a credit card, or off-line, using a check, money order, purchase order, or other payment means. Because the vendor is the issuer of the electronic tokens, there is no need for transactions to be handled by a third party, such as a bank or other organization. This reduces the overhead involved in conducting electronic commerce, and provides the vendor with a greater amount of control. Additionally, the vendor maintains total control over the price of the electronic tokens at any time. For vendors who offer software products for sale or rental, use of electronic tokens makes a variety of rental arrangements practical including rental for short periods of time, for a specific number of uses, or for a specific number of processing.

Owner:AML IP LLC

Automated banking machine currency tracking system

InactiveUS20030085271A1Simpler customer interfaceOptimizationComplete banking machinesFinanceEngineeringMoney order

An automated banking machine (10) includes a user interface (12) including an opening (20). Users of the machine deliver and receive individual sheets and stacks of sheets to and from the machine through the opening. Stacks of sheets may include sheets such as notes, checks or other documents. Stacks input to the machine may include mixtures of various types of sheets. The machine operates to receive notes, process checks and perform other operations. Notes received in the machine and assessed as valid may be recycled and dispensed to other users. Notes assessed by the machine as being of questionable validity may be marked with a removable mark and subjected to further analysis. Checks processed by the machine may be imaged by an imaging device, cancelled and stored in the machine or alternatively returned to a user. Documents produced by the machine such as receipts, checks or money orders as well as notes dispensed from the machine may be assembled into a stack within the machine and delivered from the machine through the opening.

Owner:DIEBOLD NIXDORF

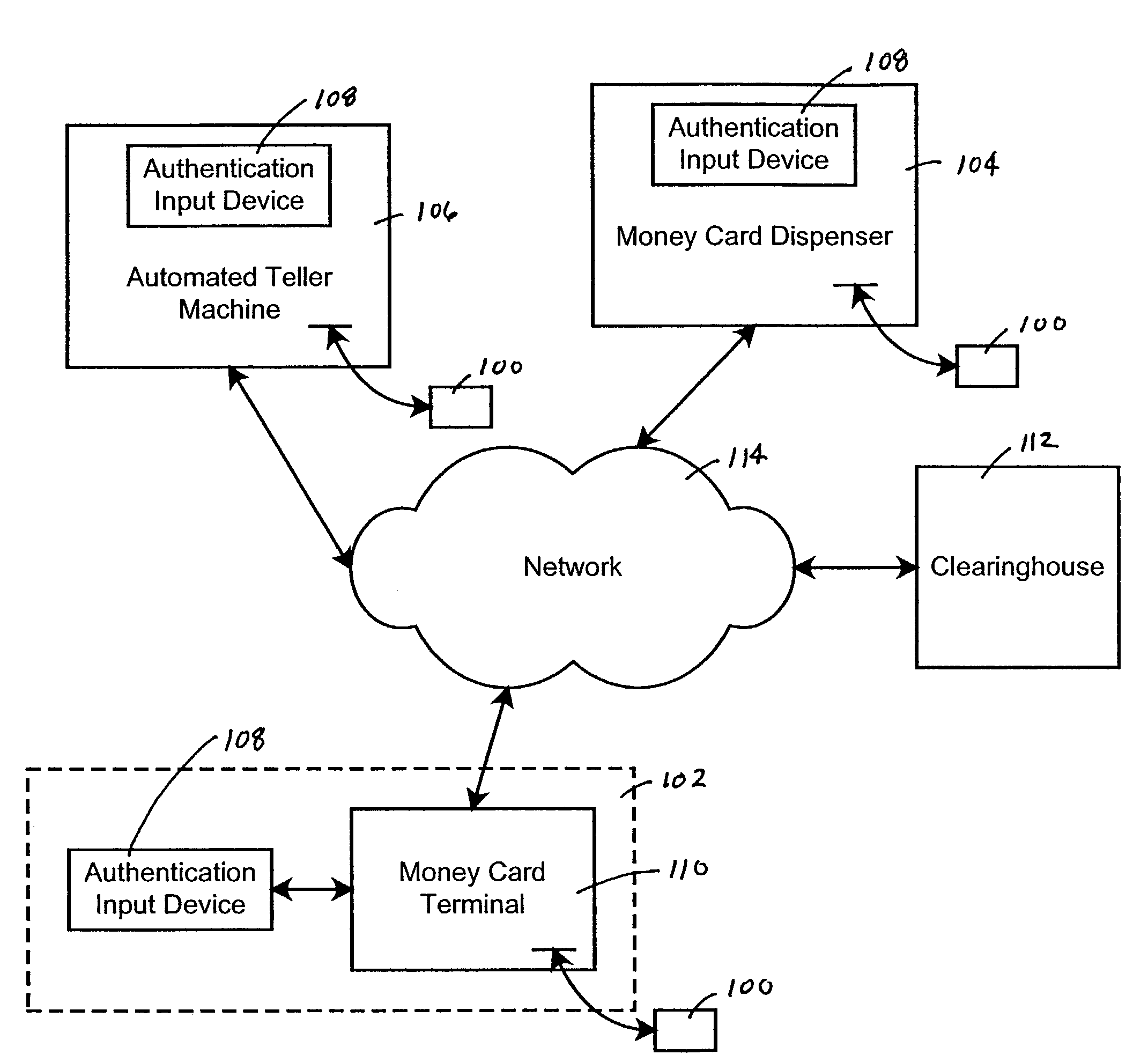

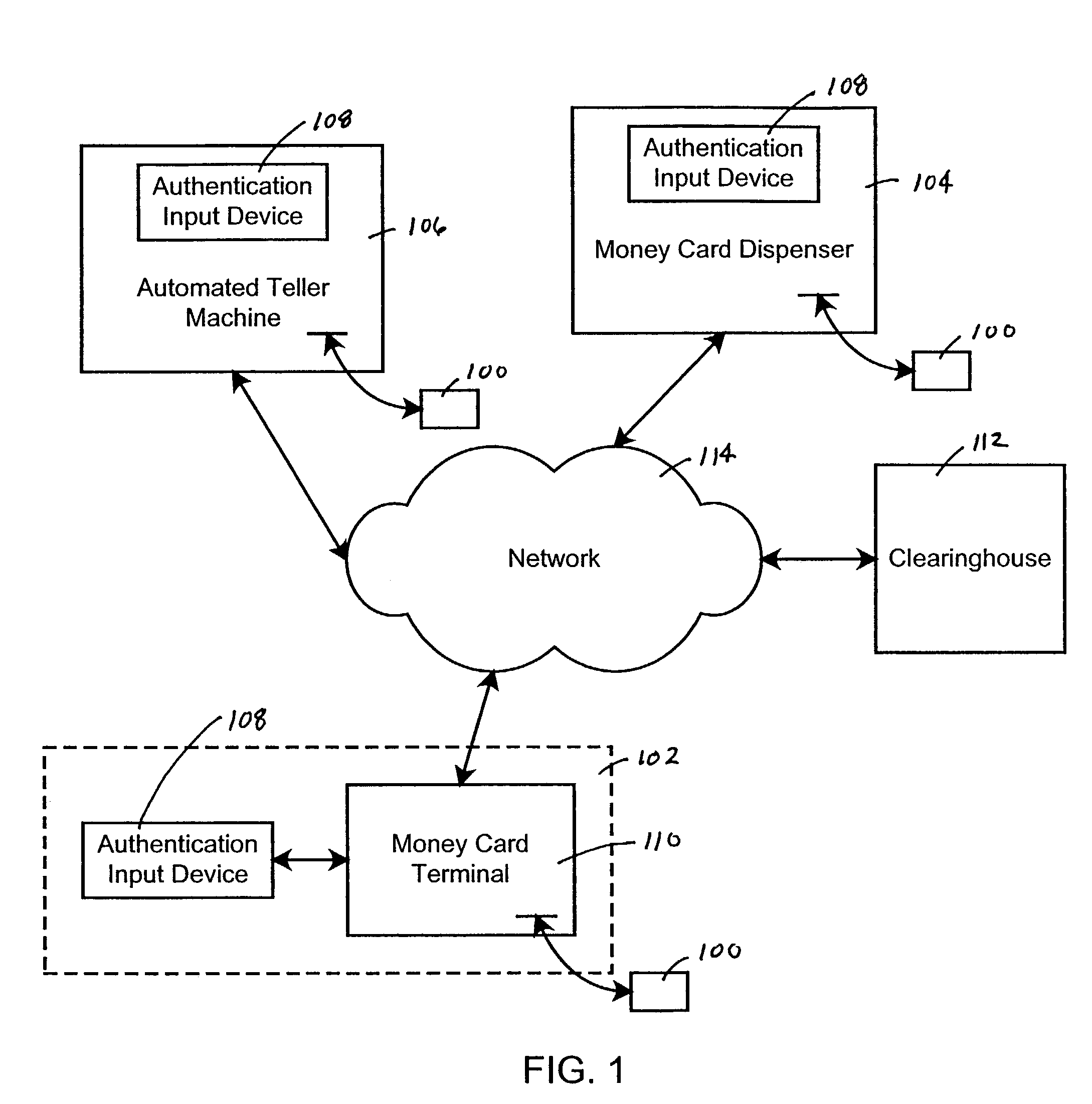

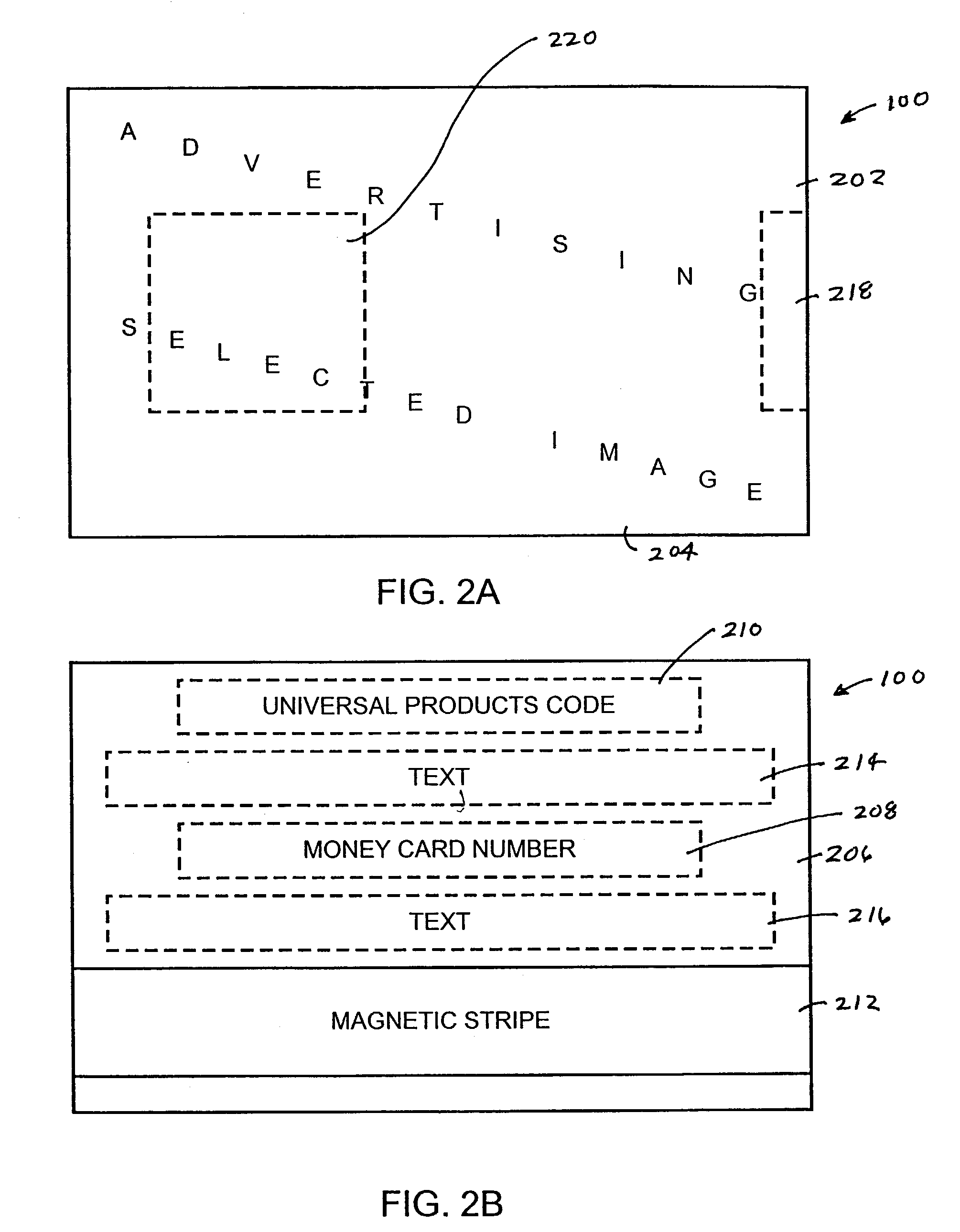

Money card system, method and apparatus

InactiveUS7280984B2Easy to useFunction increaseComputer security arrangementsDebit schemesPersonalizationSmart card

The present invention provides a money card system, method and apparatus that is convenient, easy to use, does not require good or any credit, is useable by individuals having low incomes, is interchangeable with cash, is available in many currencies, can be used in COD transactions, and is safer than cash, checks, money orders, cashier's checks, traveler's checks, ATM cards, credit cards, debit cards, stored-value cards and smart cards. For these individuals, the money card would provide the functionality of cash enhanced with the security of a Personal Identification Number (PIN) or Personal Identification Code (PIC) or other biometric information, such as fingerprint, handprint, voiceprint, iris scan, retina scan, thermal image, electronic / digital signature or any other form of endorsement that may be used to personalize and secure the transaction.

Owner:PHELAN PATRICIA MS

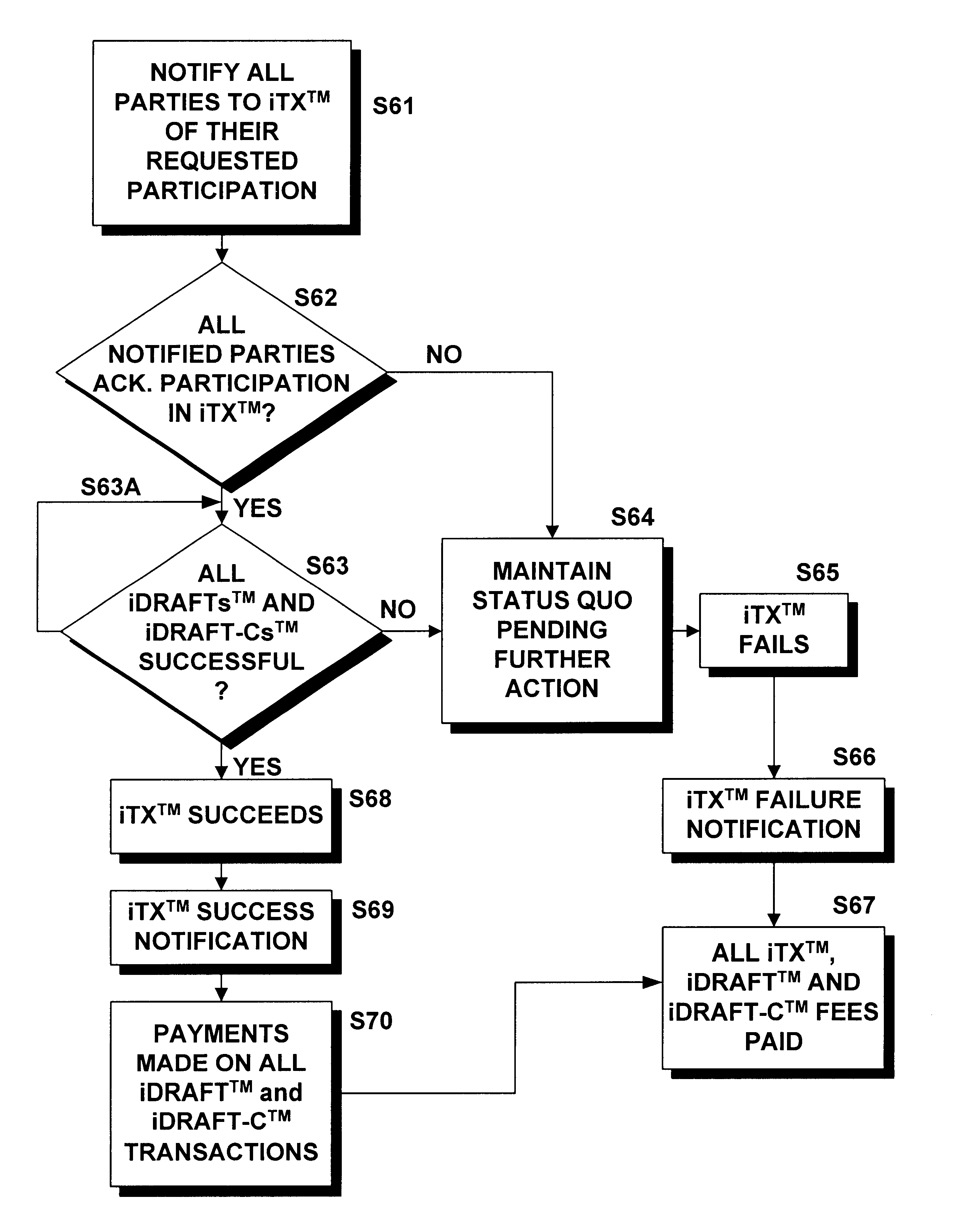

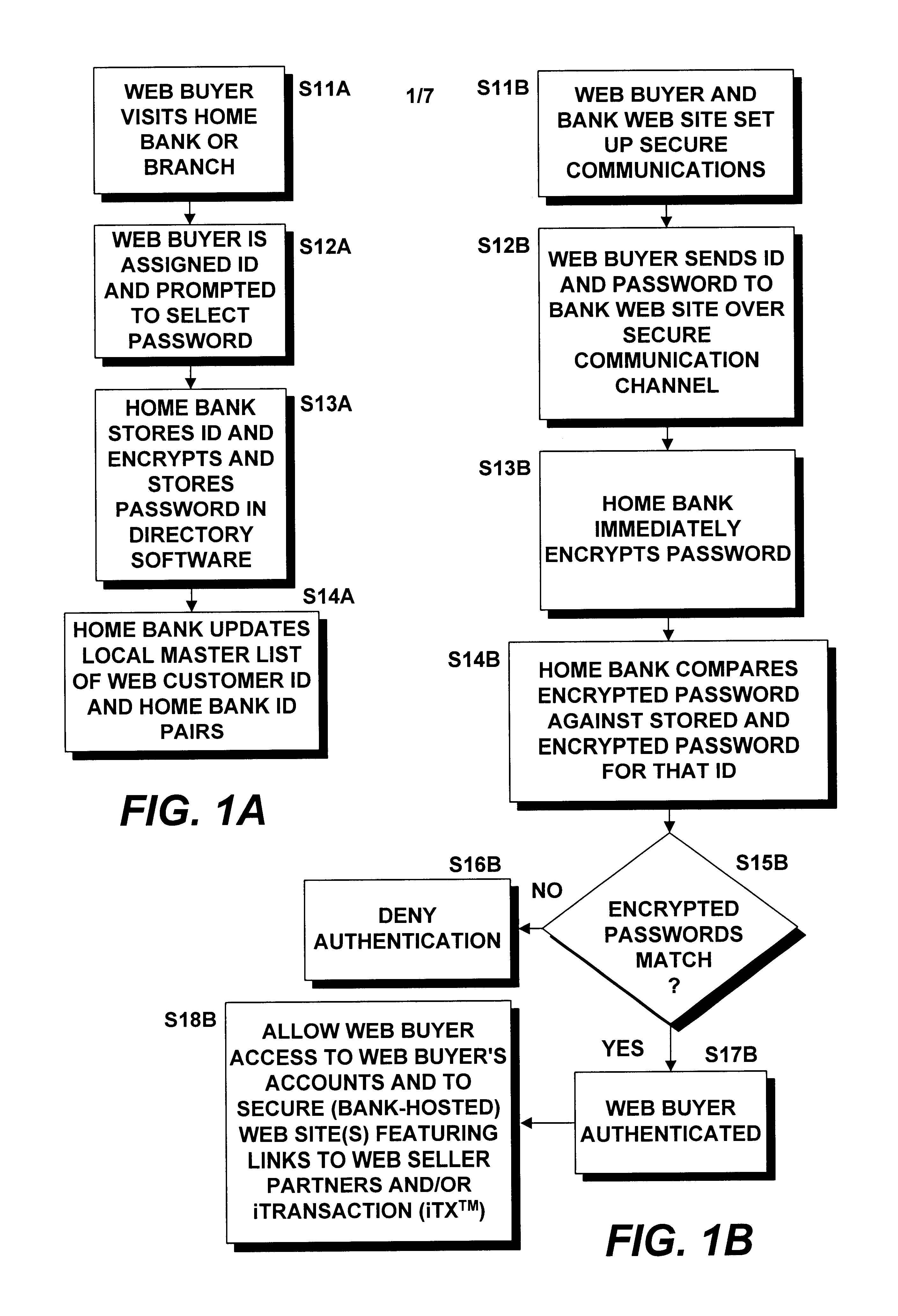

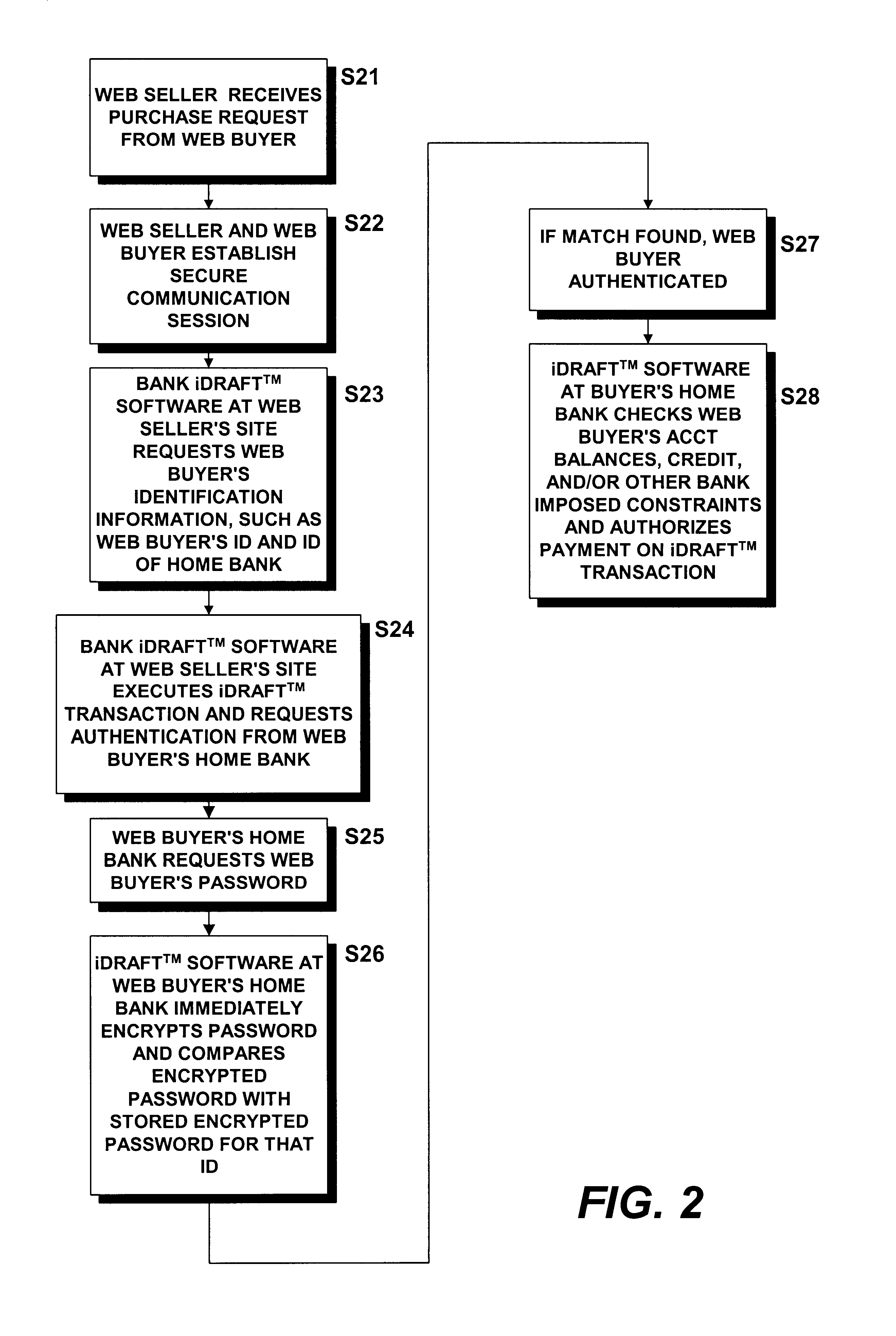

Methods and systems for carrying out directory-authenticated electronic transactions including contingency-dependent payments via secure electronic bank drafts

InactiveUS6941282B1Ensure integrityEnsure safetyFinancePayment circuitsCredit cardDocumentation procedure

Disclosed herein are computer-implemented methods and systems for securely carrying out electronic transactions including electronic drafts, wherein payment on at least one of the drafts is contingent upon the removal of an associated contingency. The method may include steps of establishing a secure computer site accessible only by authenticated parties to the transaction and by any authenticated contingency approver. The site includes a representation of the transaction that includes a representation of each of the plurality of drafts and an option to remove any contingencies associated therewith. Parties and contingency approvers requesting access to the computer site are authenticated by encrypting identification information provided by the requesting party or contingency approver over a secure channel and successfully matching the encrypted identification information with an encrypted identifier that is stored by a bank, the encrypted identifier being unique to the requesting party or contingency approver. Payment on the constituent drafts of the transaction are released by the bank only when the option to remove each contingency associated with the draft is timely exercised by an authenticated party or authenticated contingency remover that is authorized to remove the contingency. Complex transactions may thereby be carried out securely, remotely and without compromising personal and / or financial information. The invention obviates the need to disseminate identification surrogates such as credit card numbers over public networks as well as the need to rely upon in-person holographic signatures on paper documents for authentication purposes.

Owner:ORACLE INT CORP

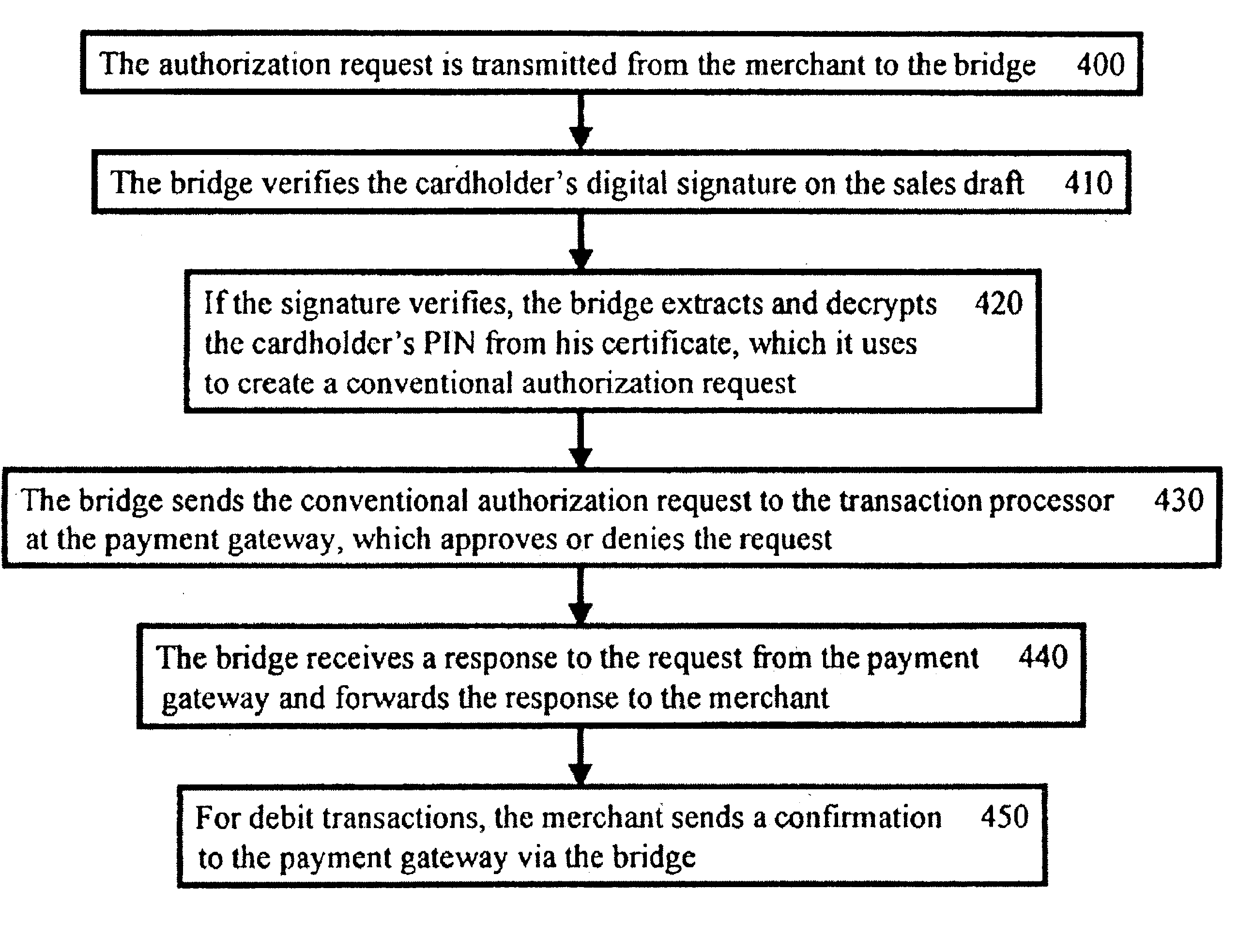

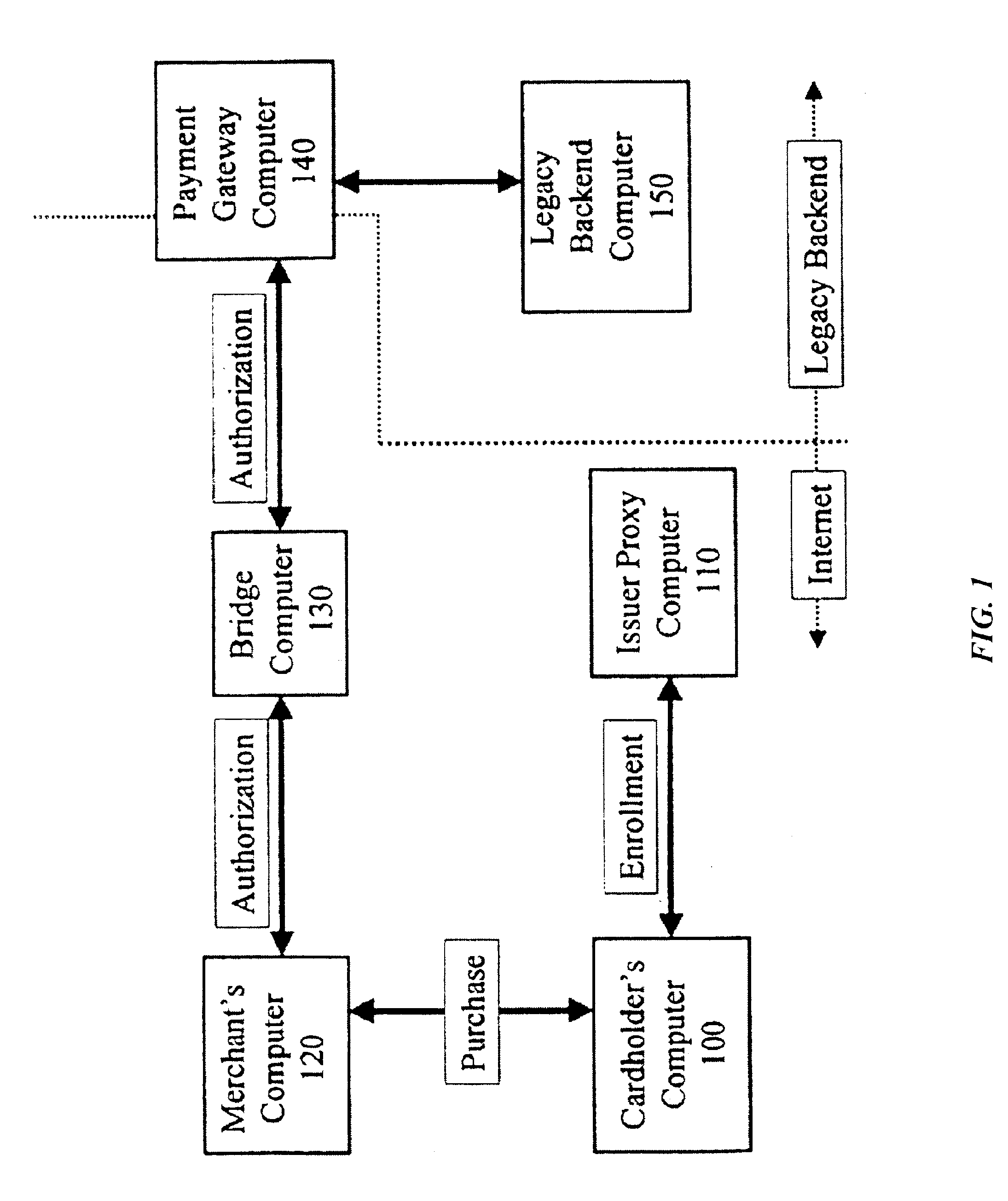

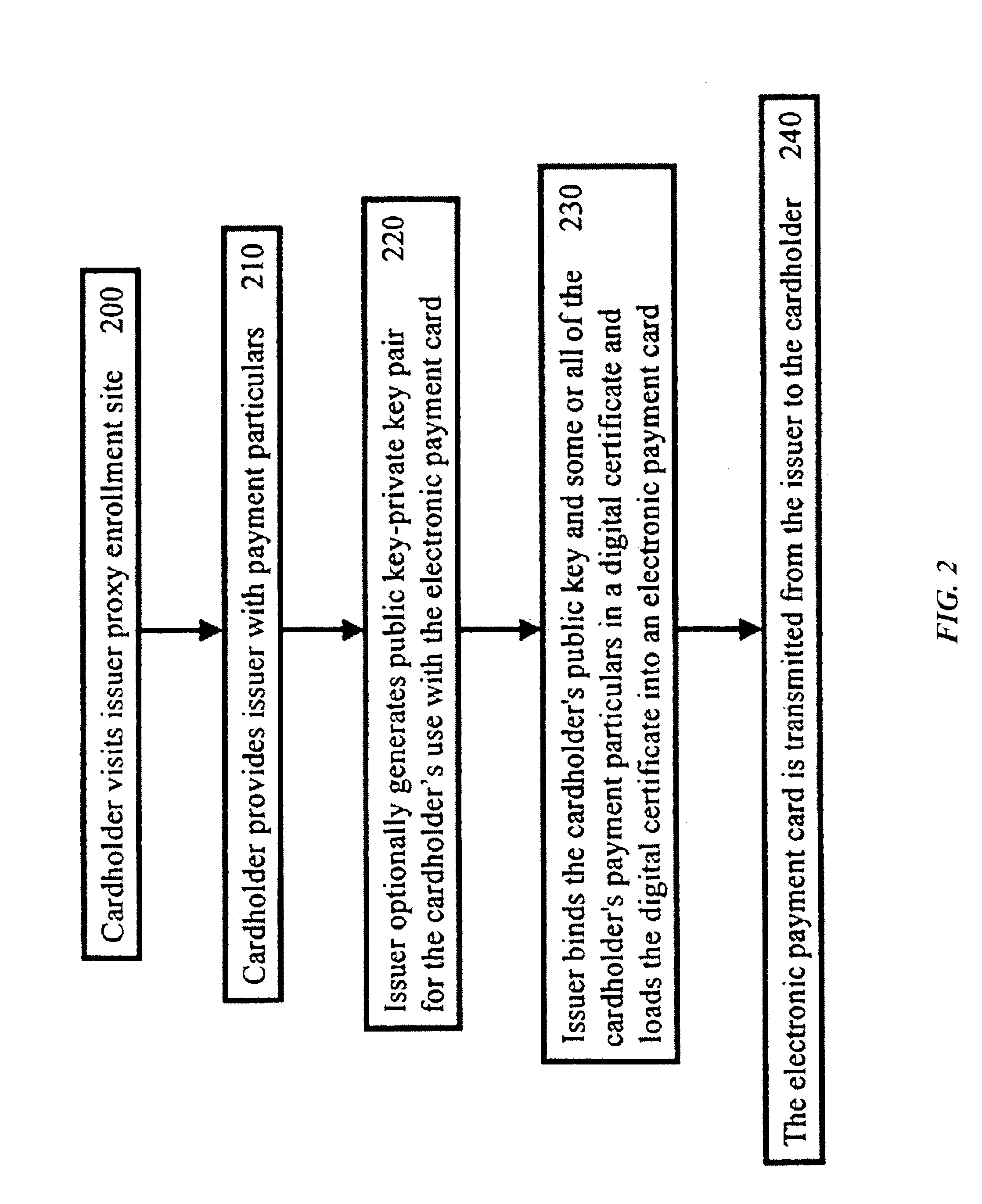

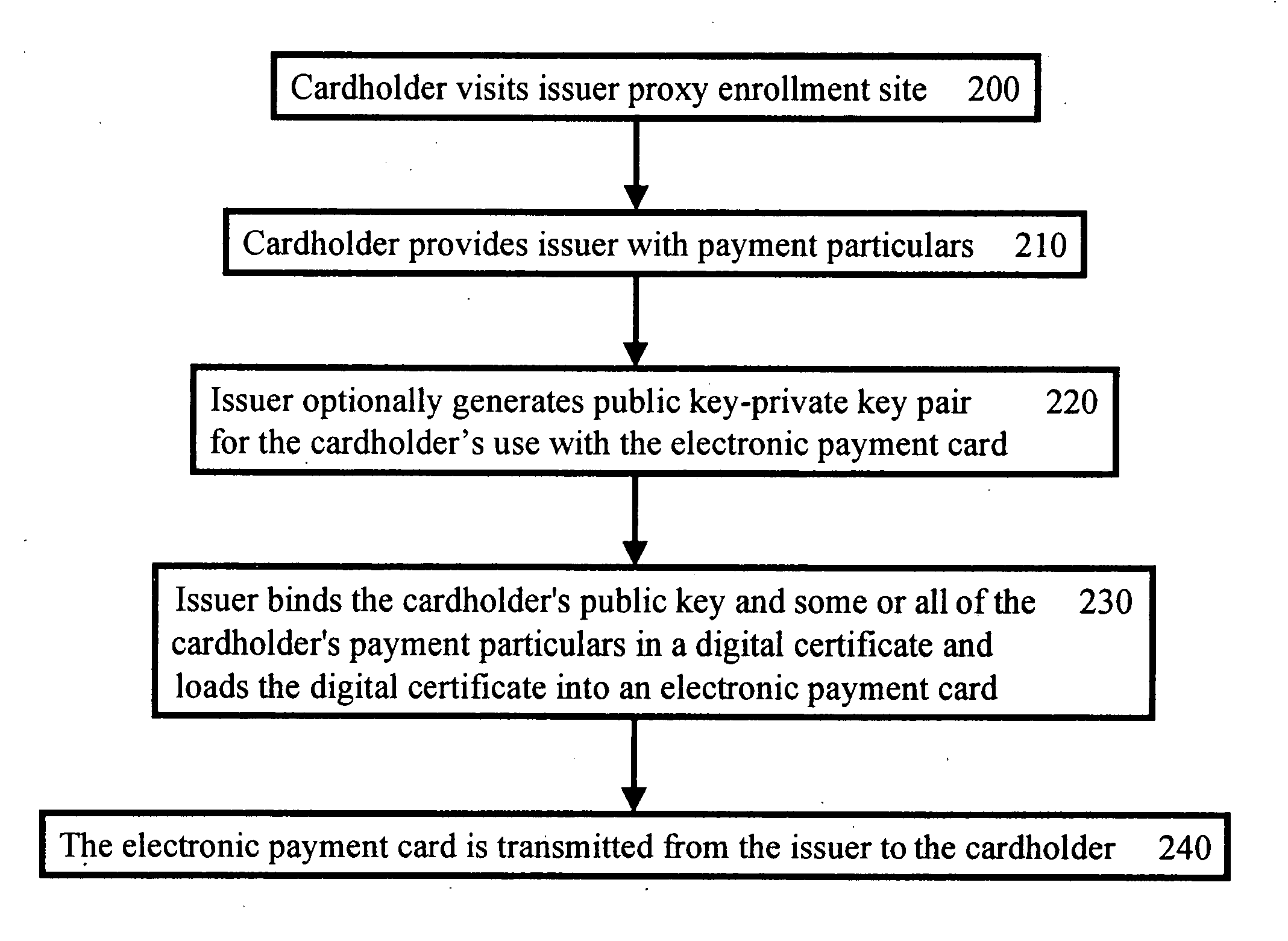

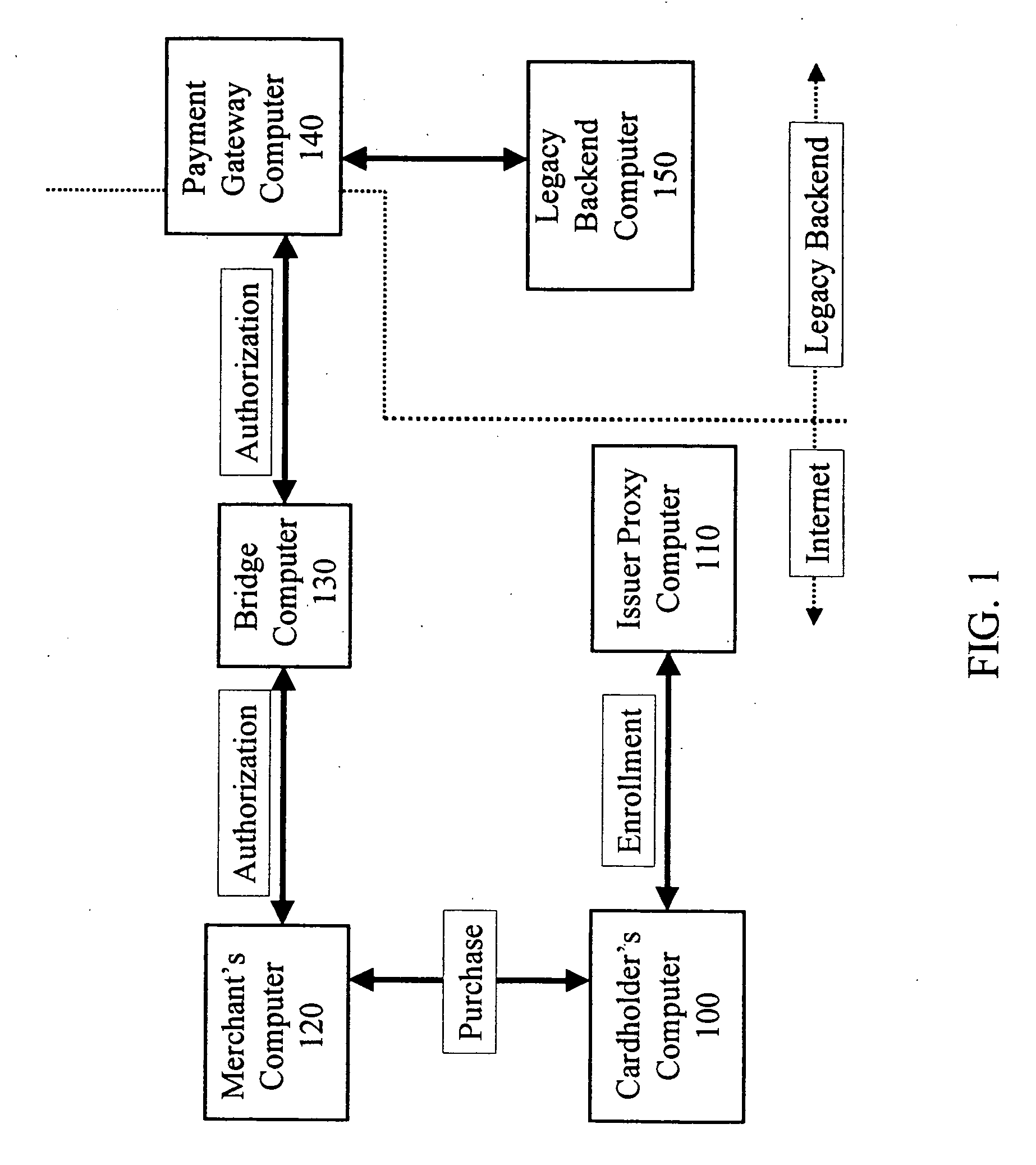

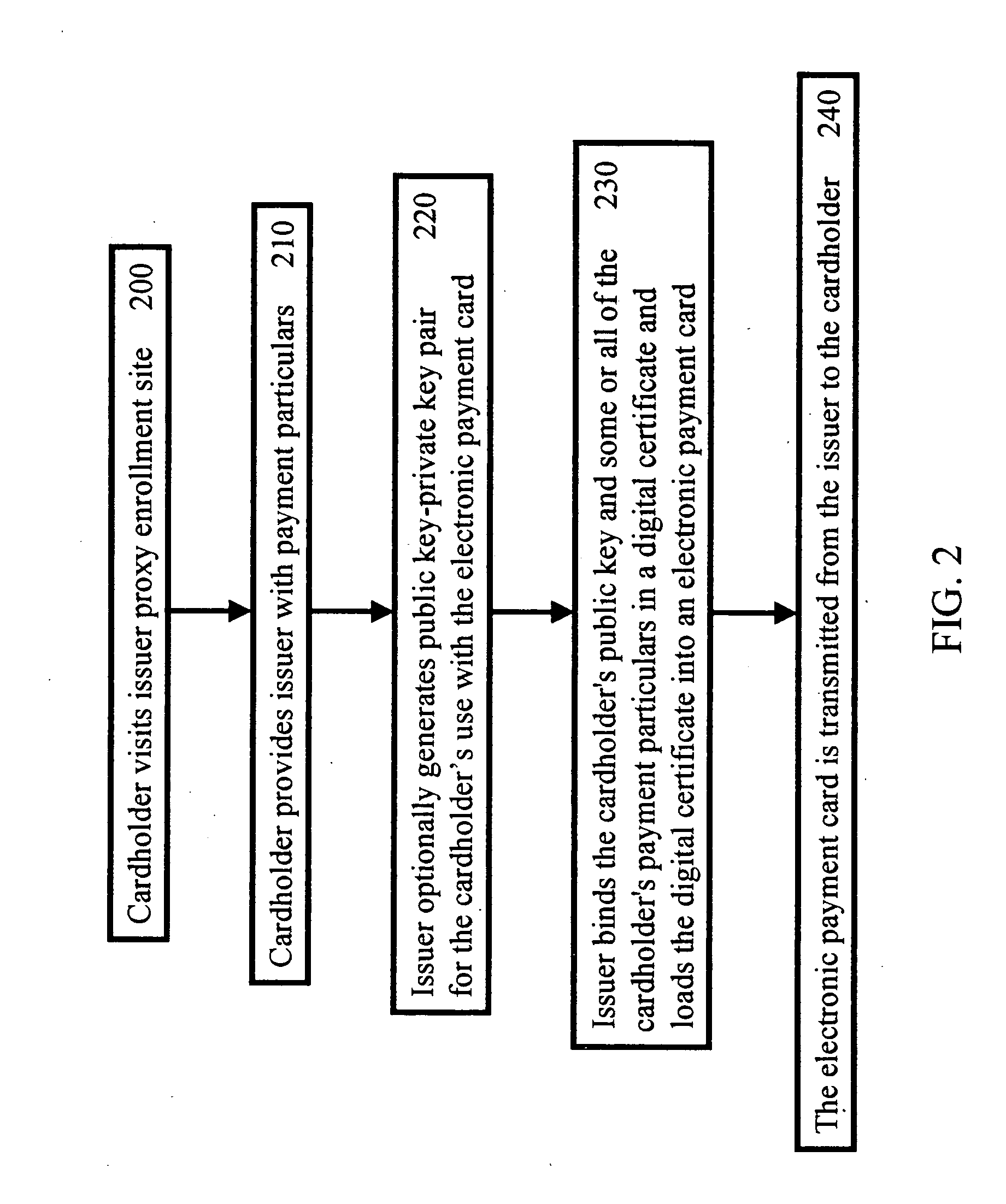

Method and system for secure authenticated payment on a computer network

InactiveUS6895391B1Simple, secure and easy-to-deployKey distribution for secure communicationUser identity/authority verificationDigital signatureThe Internet

A simple, secure and easy-to-deploy method and system for authenticating credit and debit cardholders at the point-of-sale on a computer network (e.g. the Internet) is disclosed. Cardholders are authenticated using digital signatures on a sales draft, in a manner that does not necessarily require any changes in the transaction flow of the participating financial institutions.

Owner:CA TECH INC

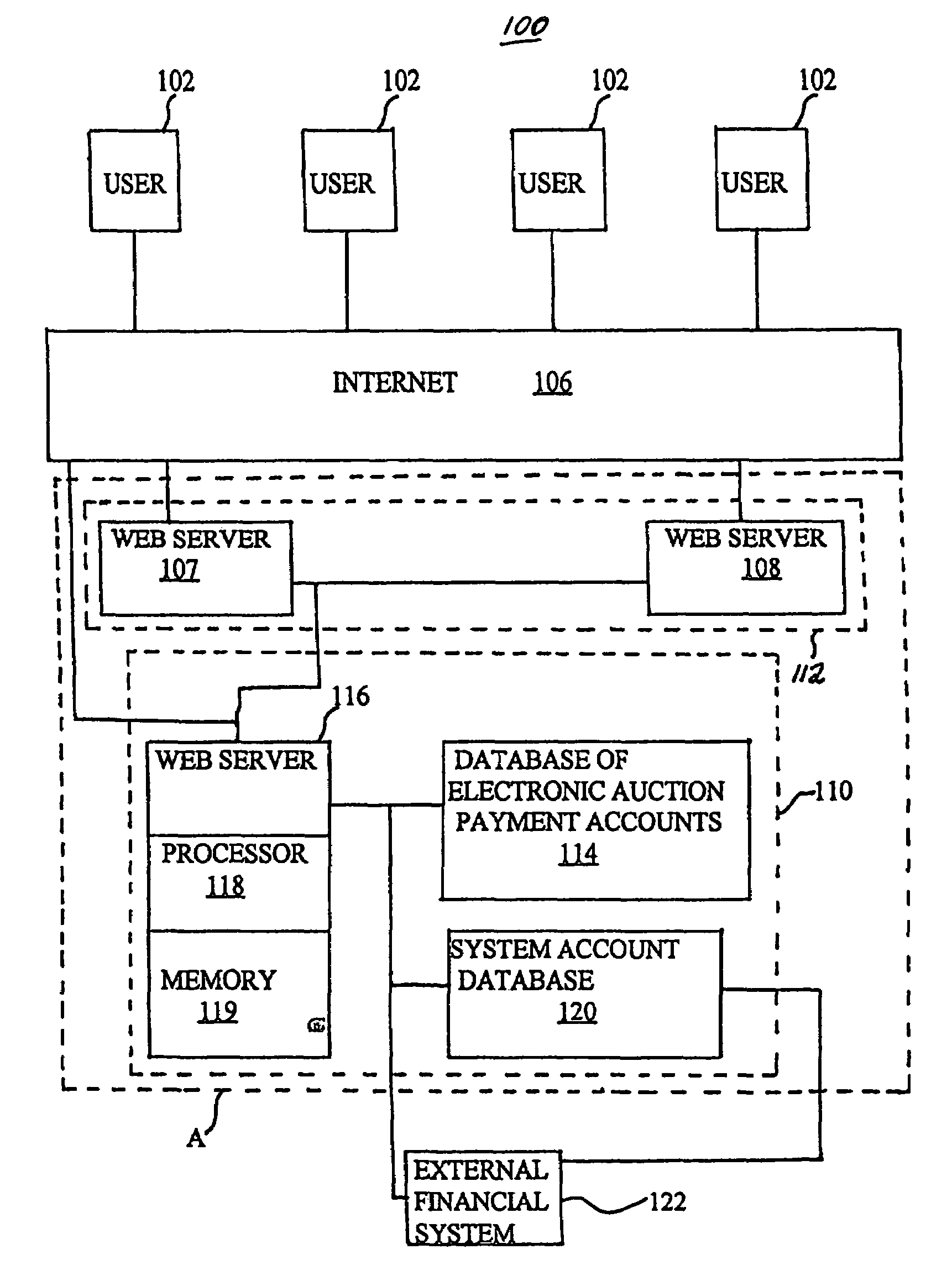

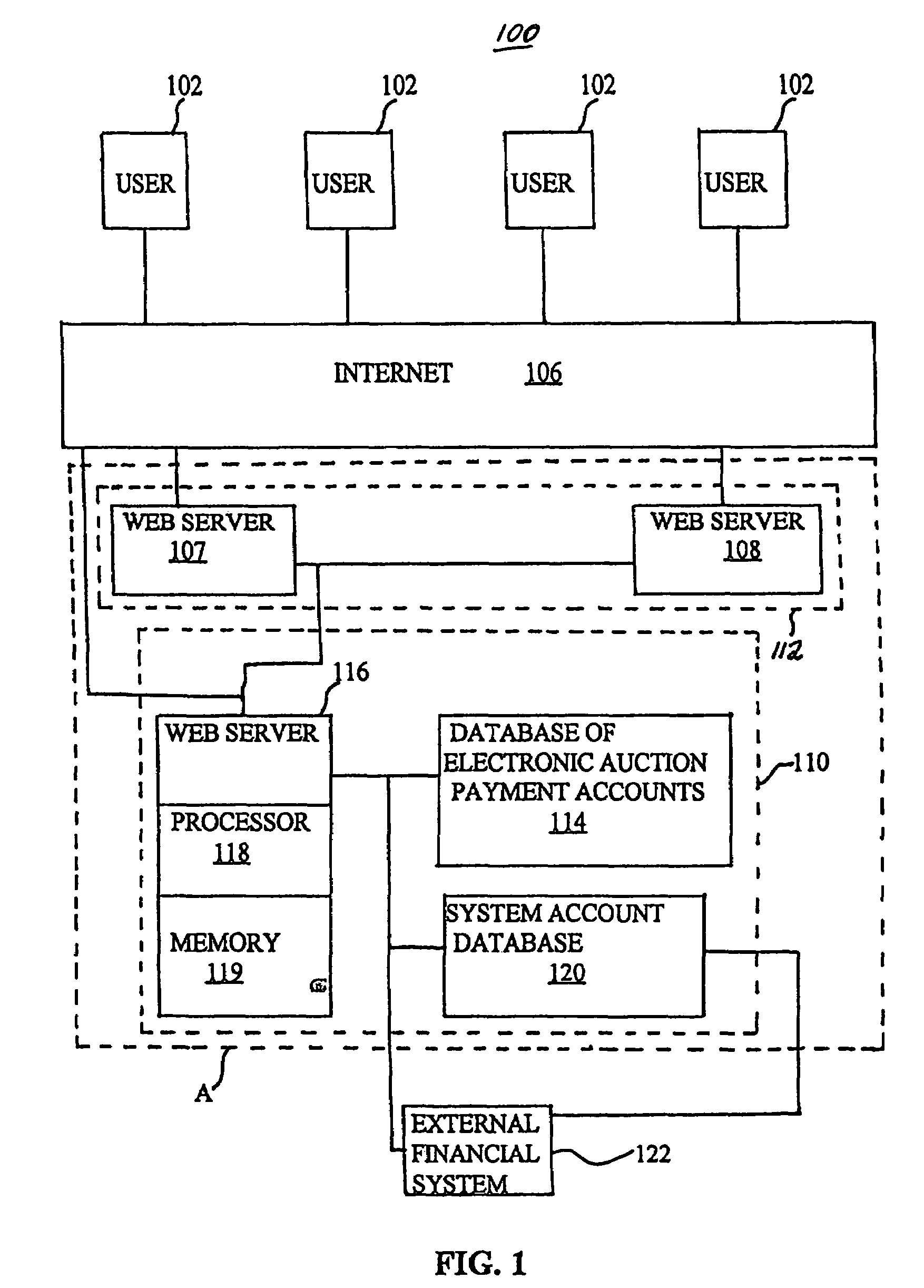

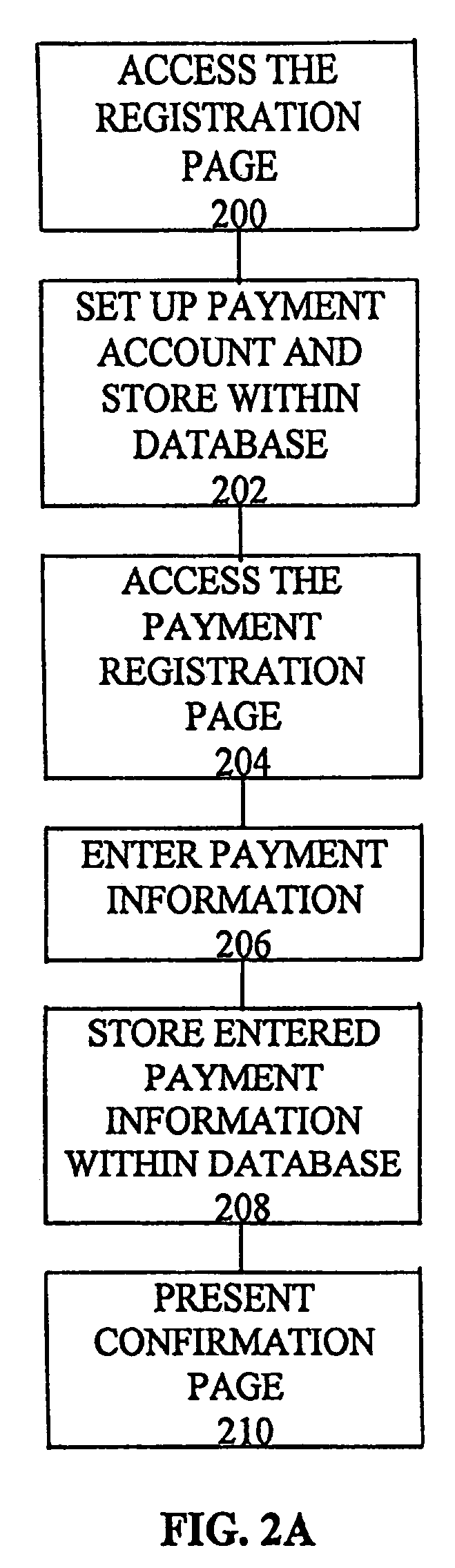

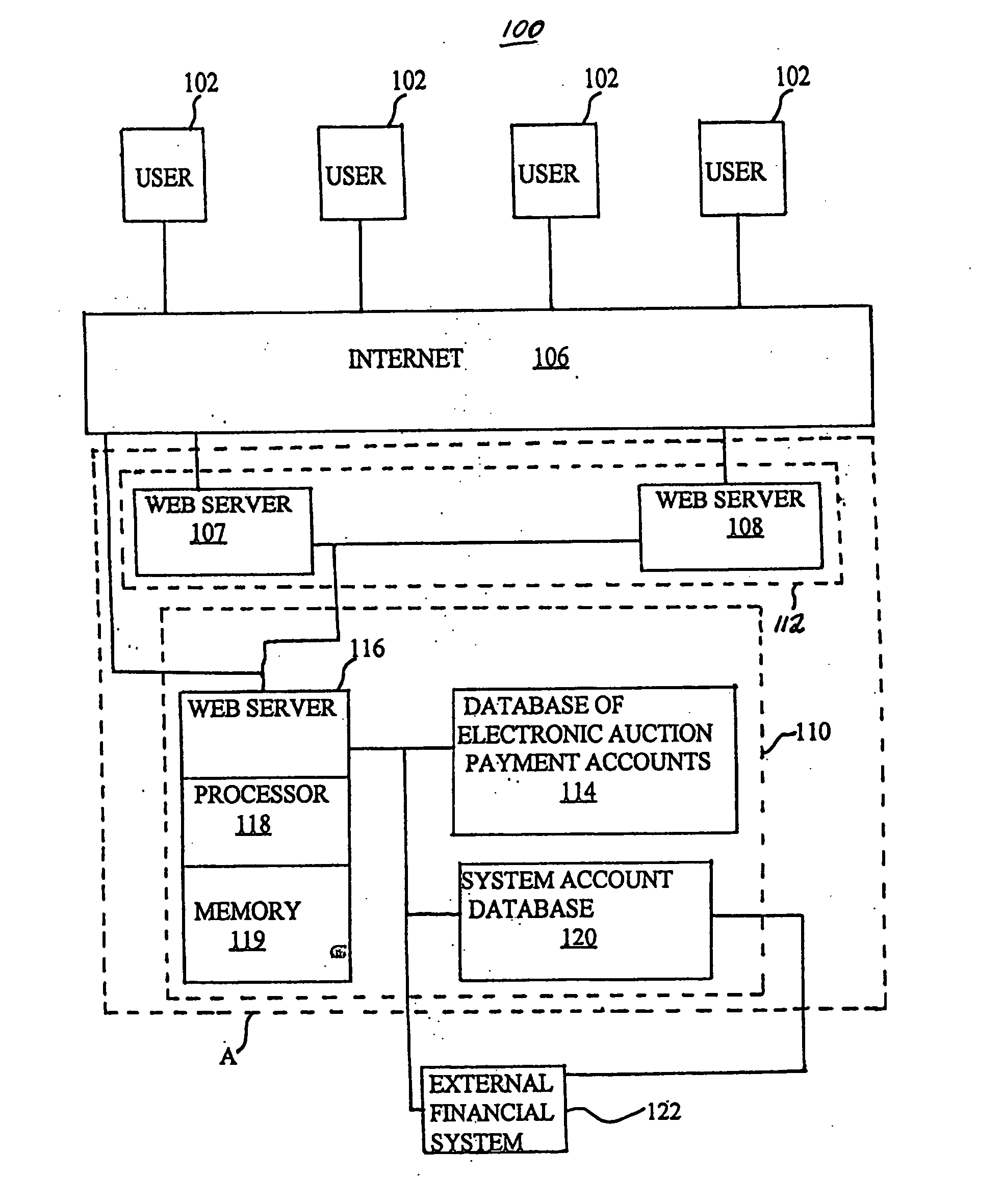

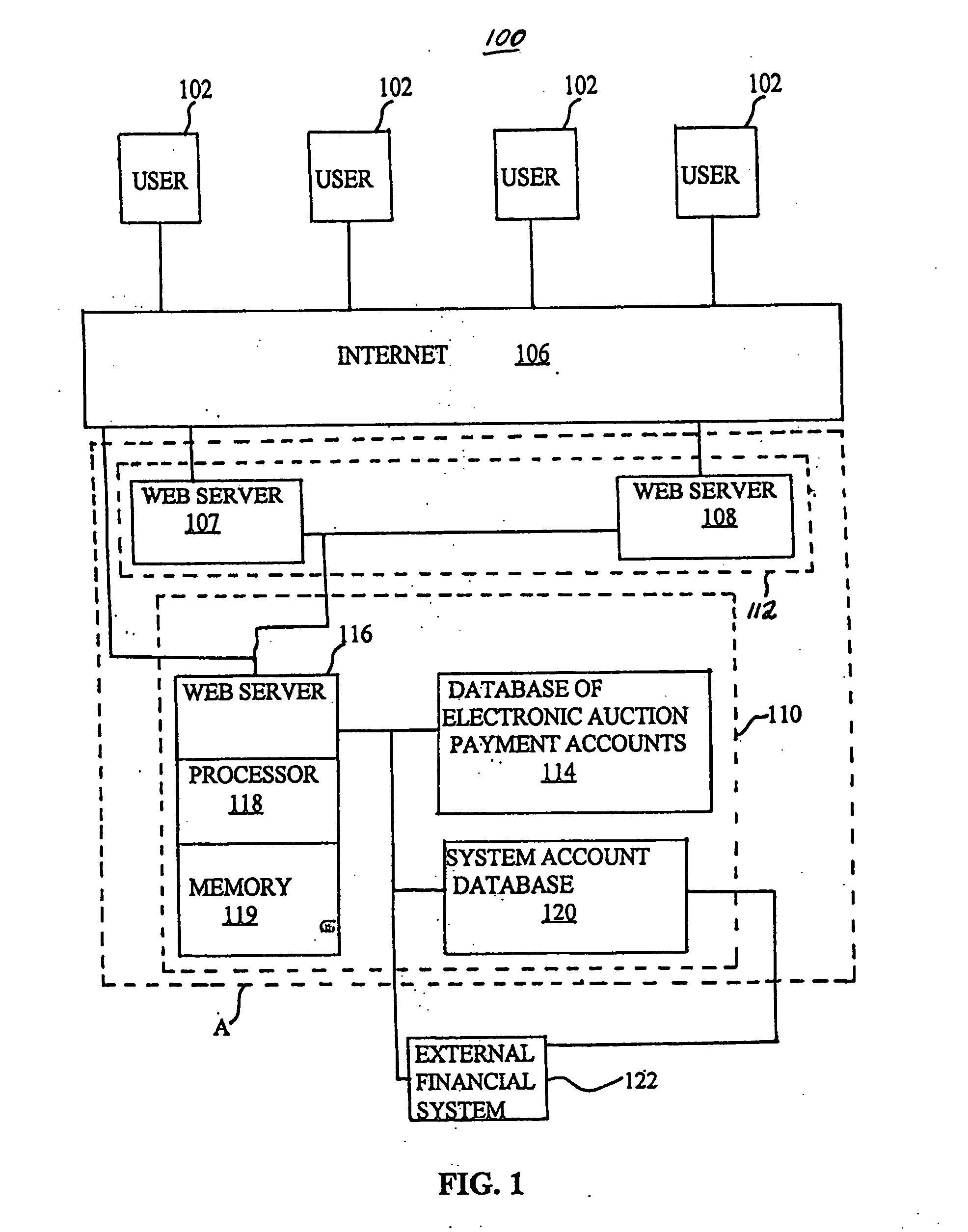

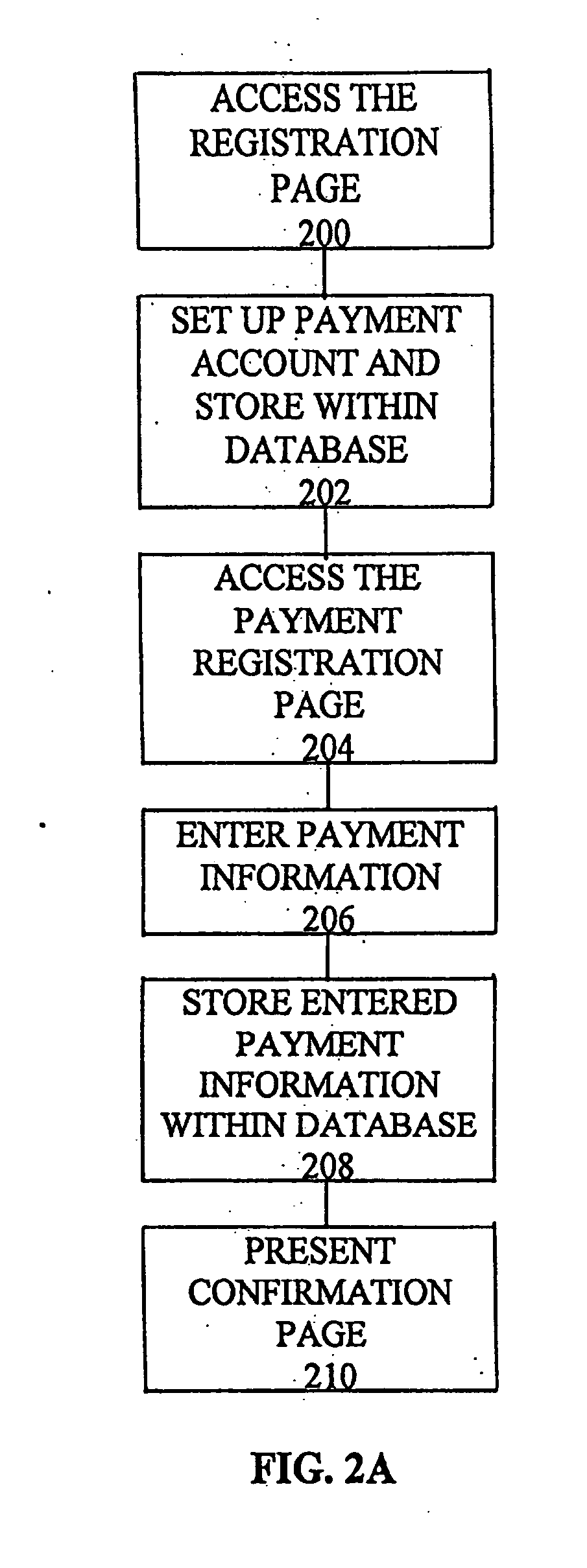

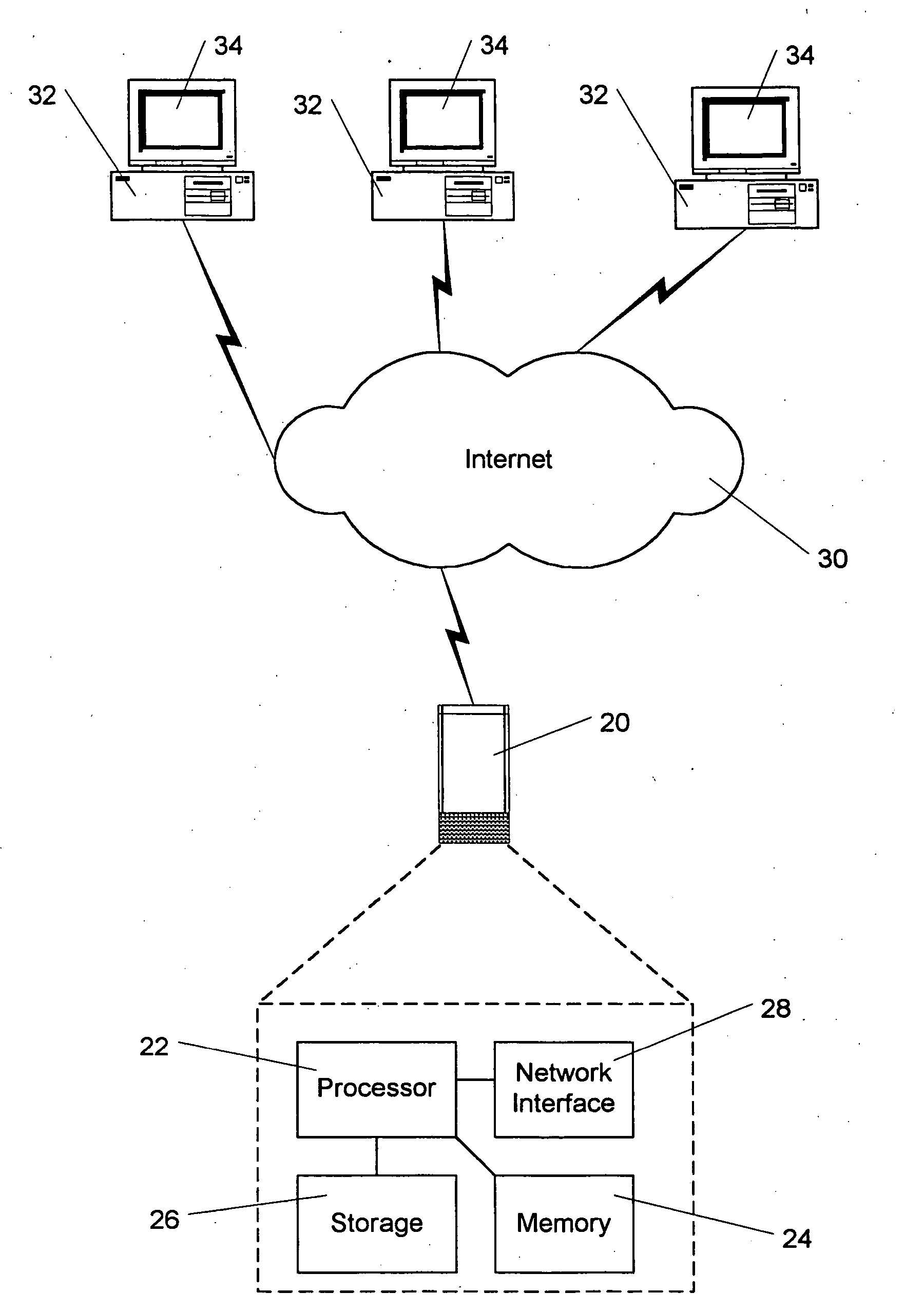

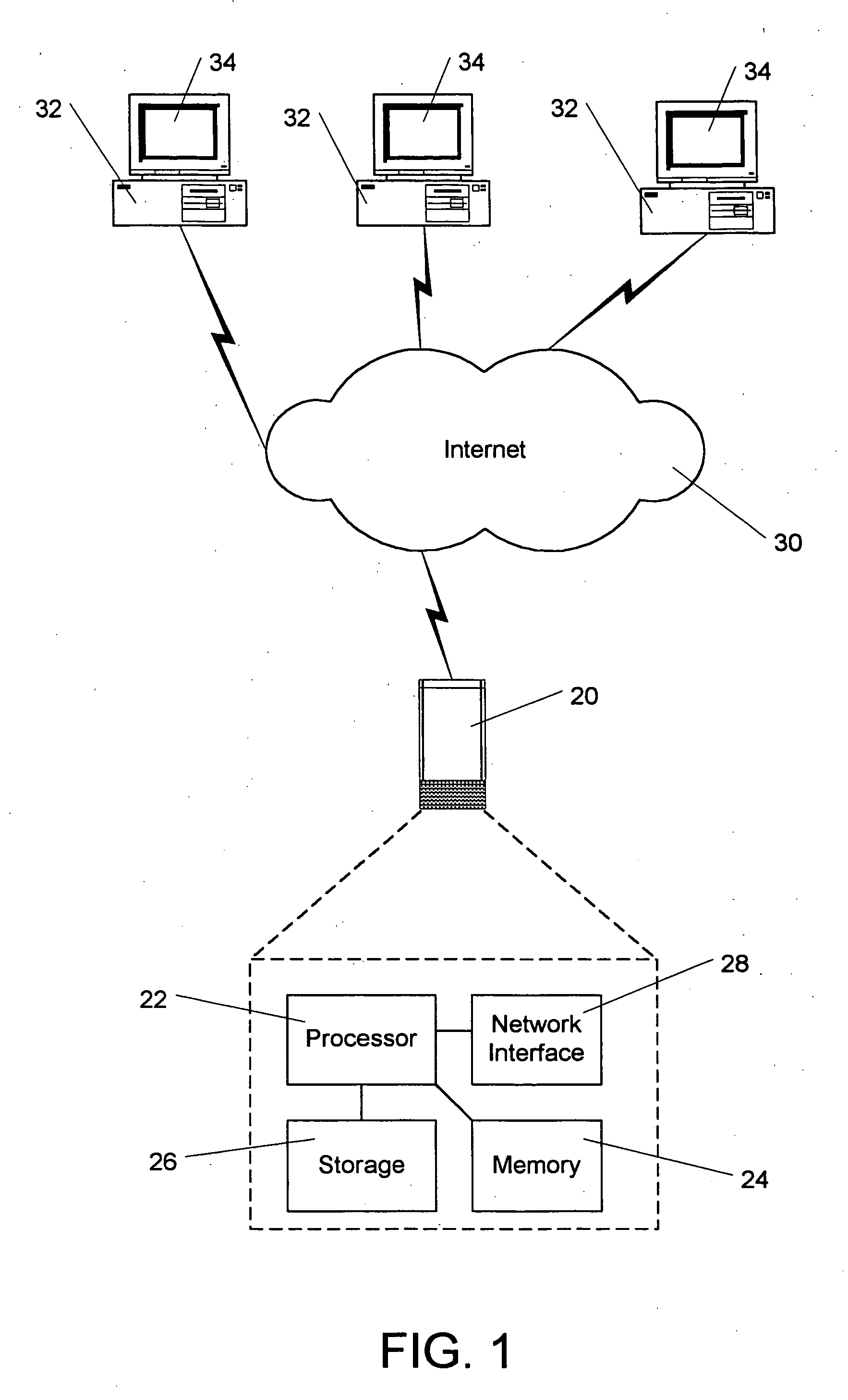

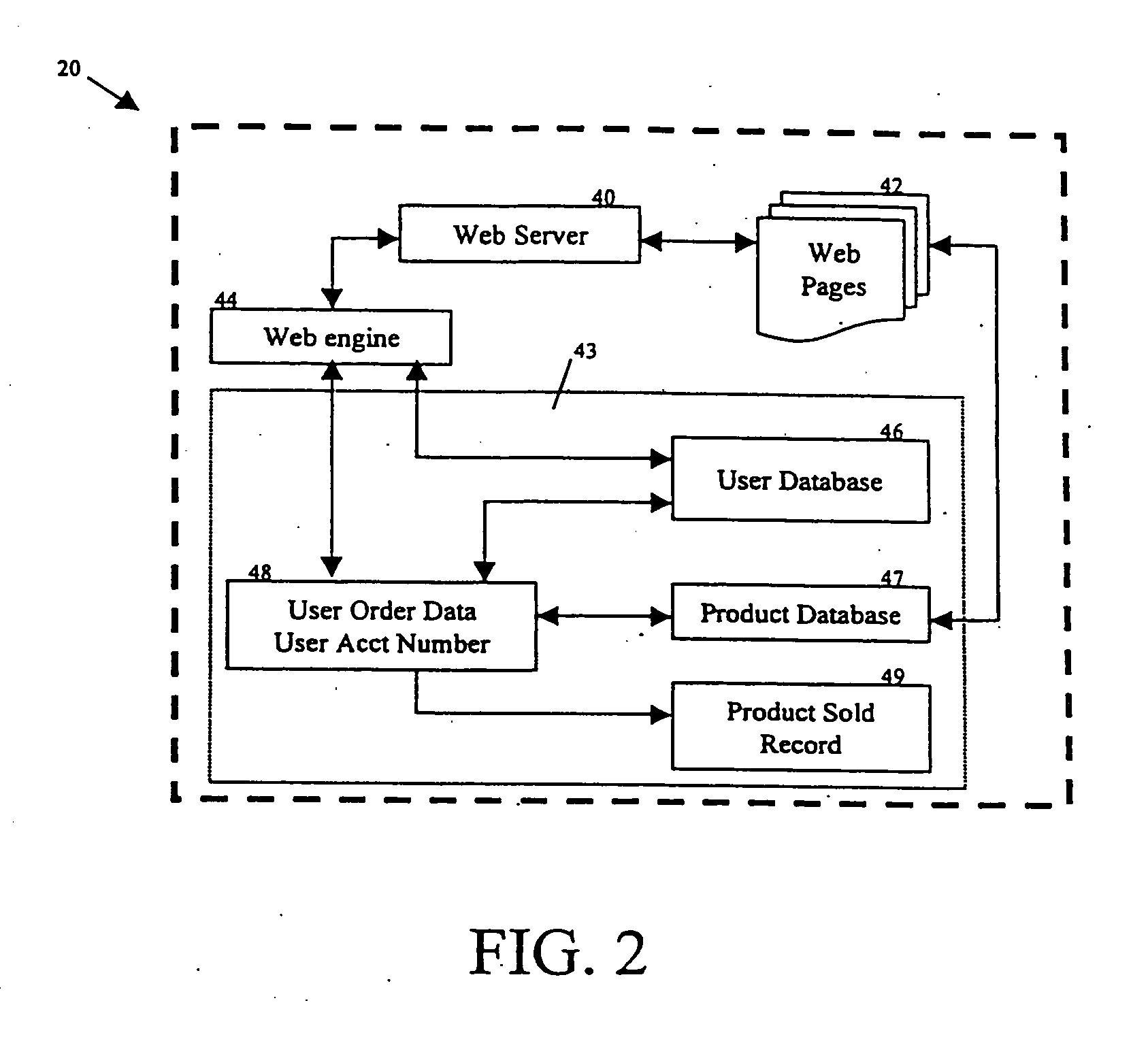

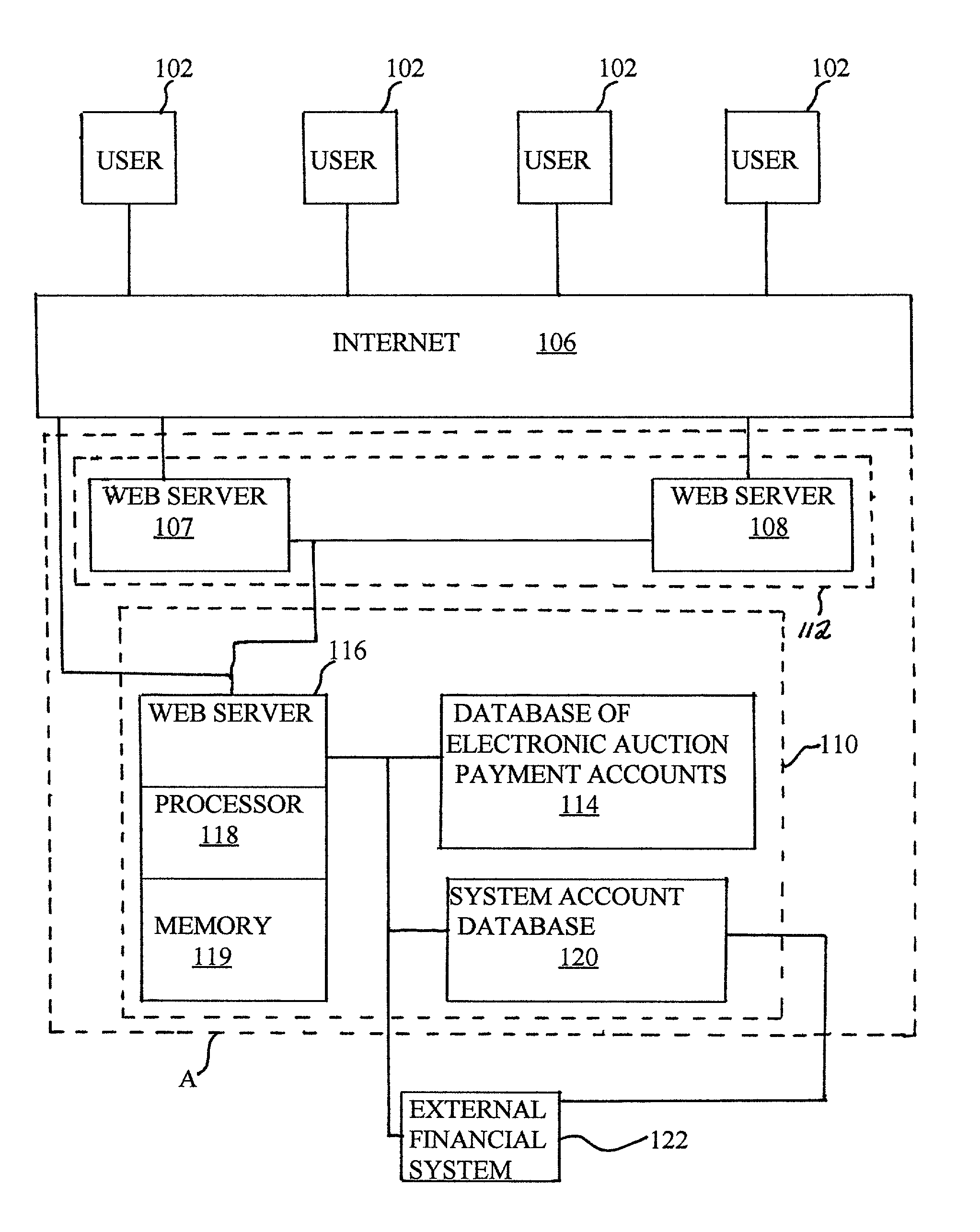

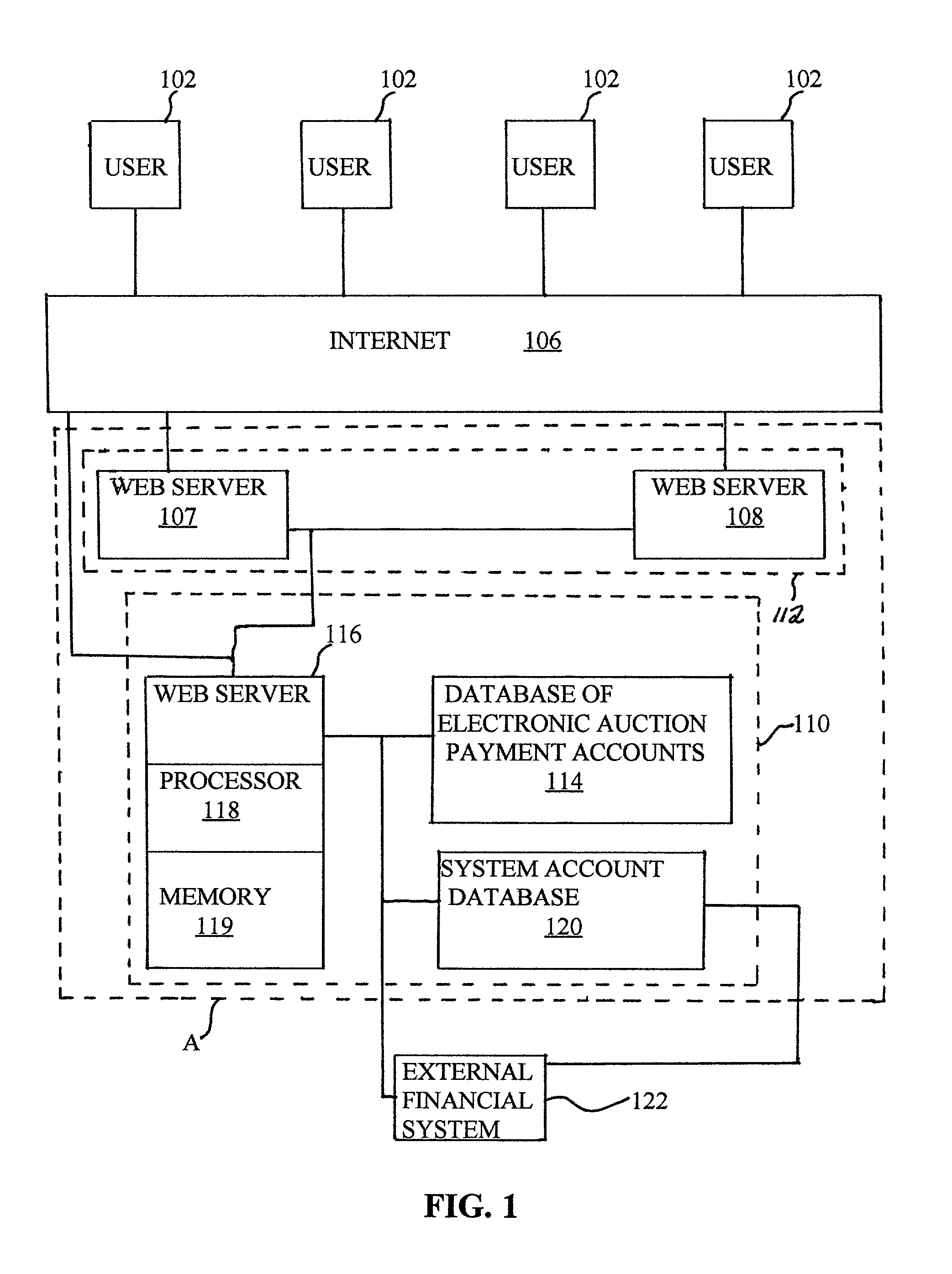

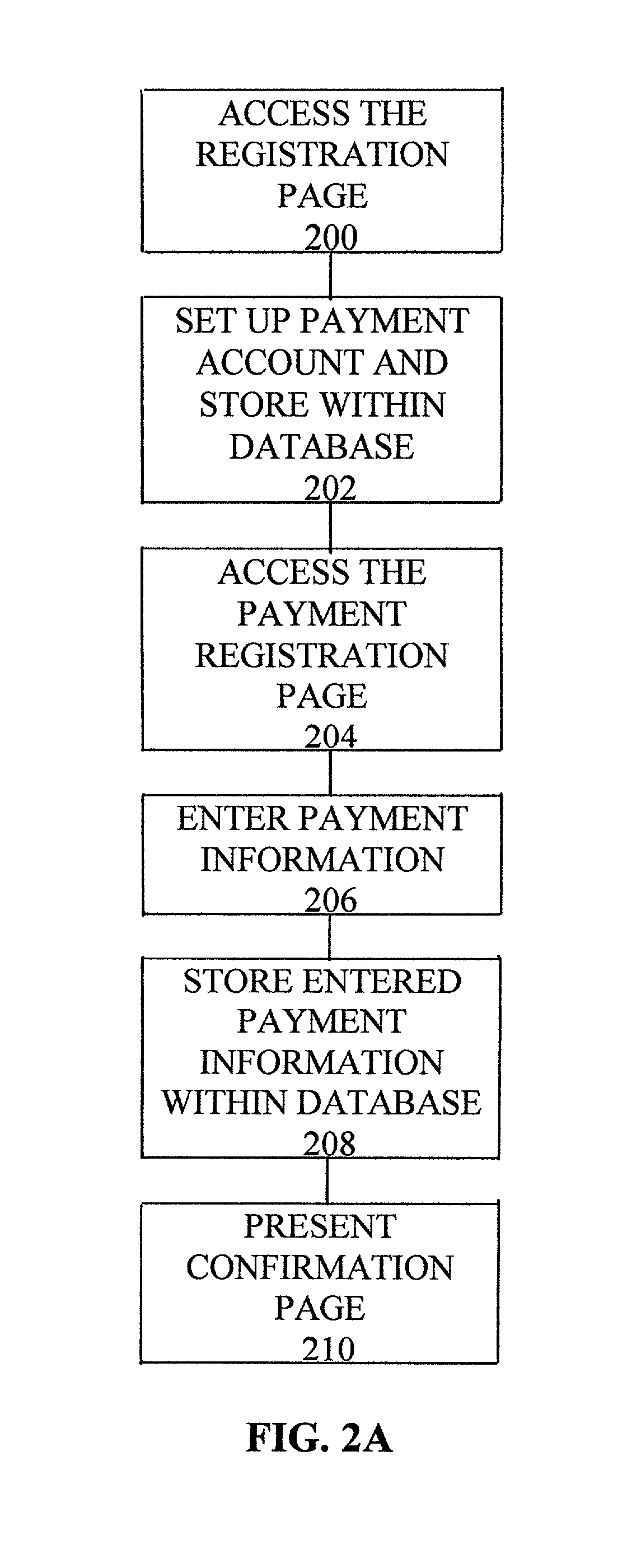

System and method to automate payment for a commerce transaction

The invention provides a computerized electronic auction payment system and method for effecting a real-time payment for an item won in an electronic auction by setting up and maintaining electronic auction payment accounts for prospective bidders and sellers. The prospective bidders provide funds to their electronic auction payment accounts maintained by the computerized electronic auction payment system, prior to being deemed as winning bidders, via direct deposit, using a credit card, or sending a check, money order, or other financial document to an operator of the computerized electronic auction payment system. In one embodiment, upon being deemed as a winning bidder, the winning bidder accesses a payment page, enters the total amount of funds to be transferred to the seller, and authorizes the computerized electronic auction payment system to effect a real-time payment by debiting his, i.e., the winning bidder's, respective electronic auction payment account and crediting the electronic auction payment account of the seller, and / or another account specified by the seller. In an alternate embodiment, the prospective bidder authorizes the computerized electronic auction payment system to effect a real-time payment to the seller upon the prospective bidder being deemed the winning bidder (i.e., immediately following the conclusion of the auction). That is, without the winning bidder having to access the payment page.

Owner:XPRT VENTURES

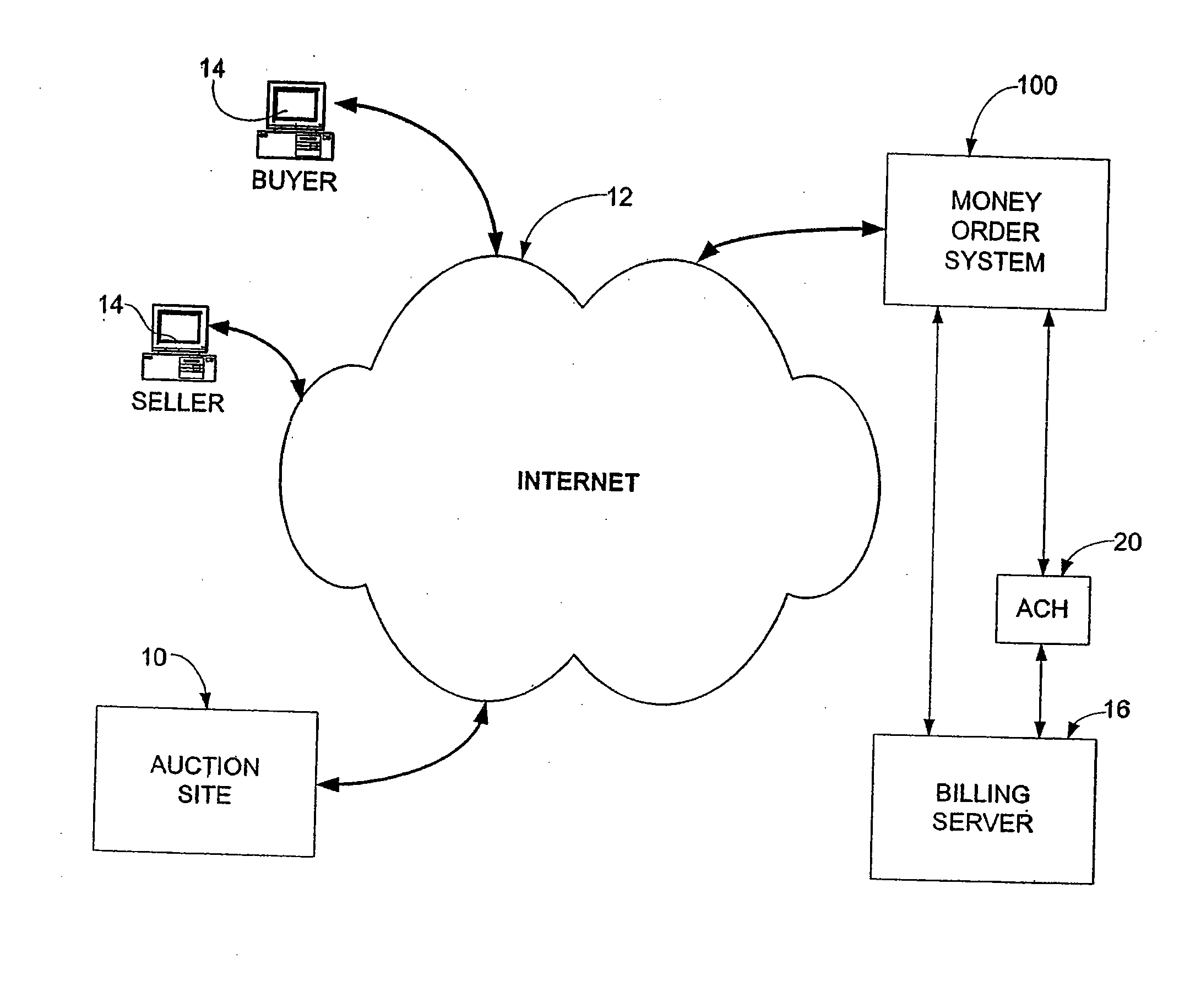

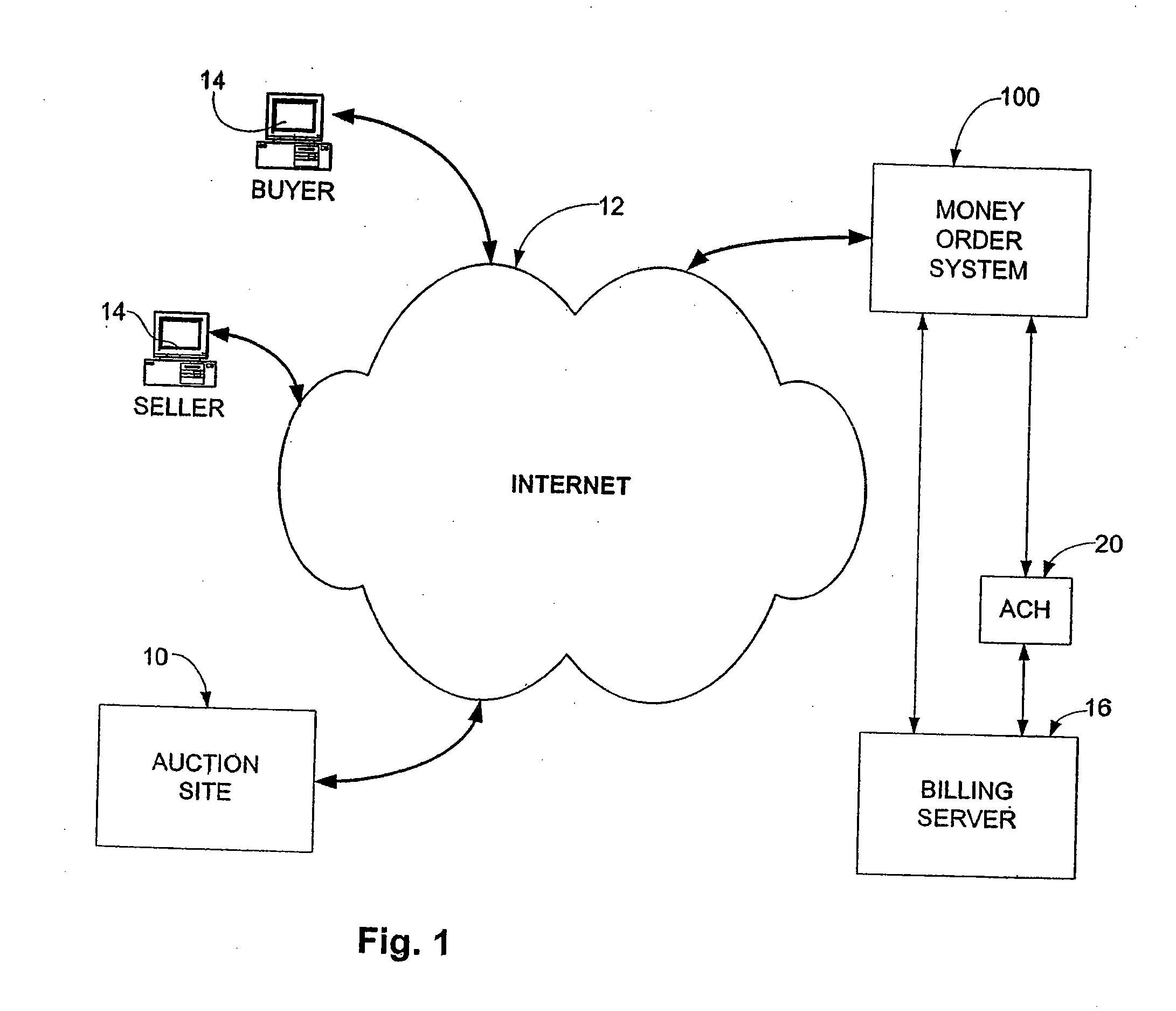

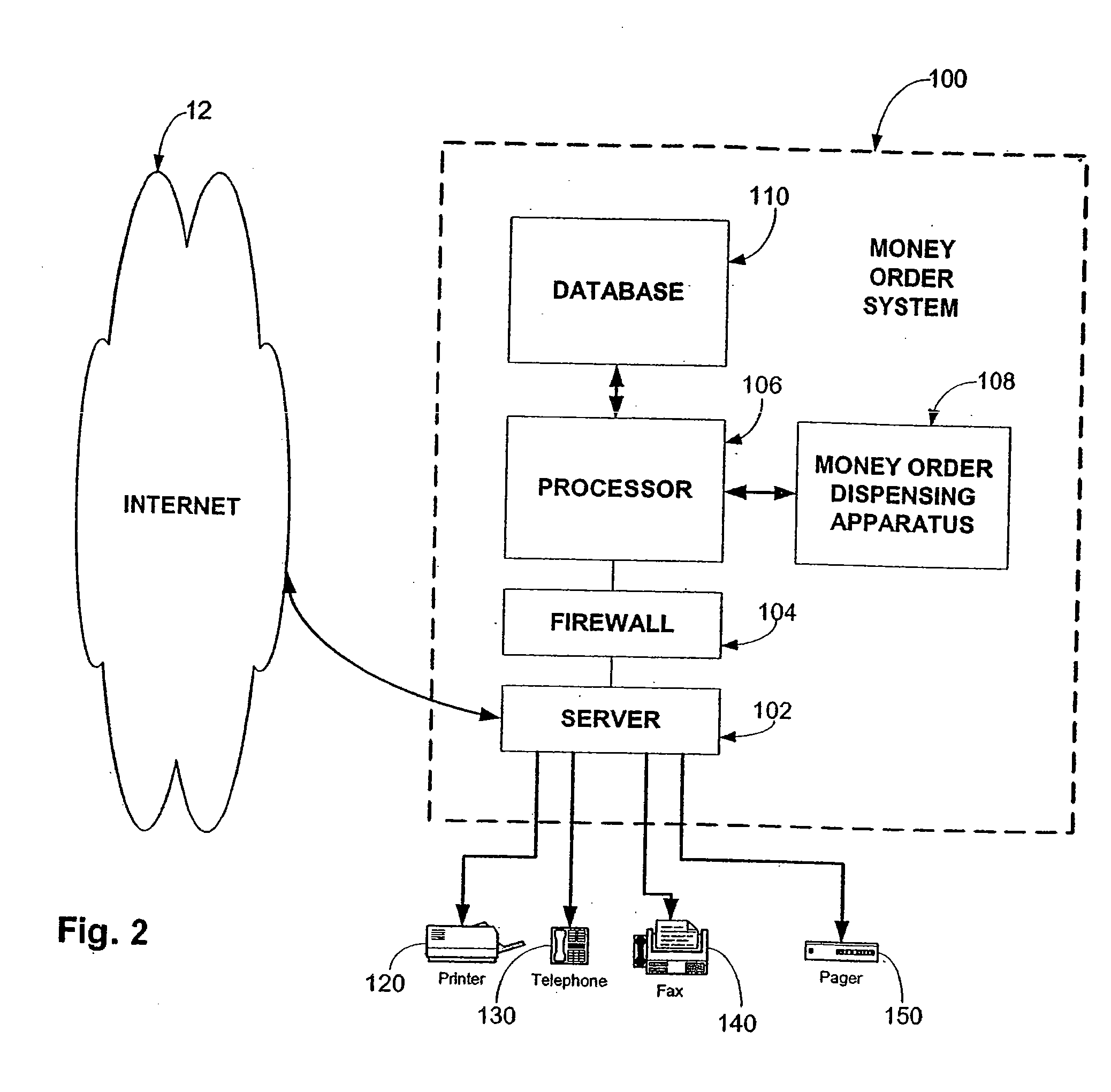

Internet-Based Money Order System

A system and method for purchasing a money order via the internet including the steps of providing an internet based money order system capable of generating money orders upon the receipt of a purchase request by a prospective buyer via the internet for a predetermined amount of funds. The prospective buyer transmits information to the money order system, via the internet, which information is required to purchase the money order. The money order is then remotely generated by the money order system and is delivered to an intended recipient of the money order.

Owner:THE WESTERN UNION CO +1

System and method to automate payment for a commerce transaction

The invention provides a computerized electronic auction payment system and method for effecting a real-time payment for an item won in an electronic auction by setting up and maintaining electronic auction payment accounts for prospective bidders and sellers. The prospective bidders provide funds to their electronic auction payment accounts maintained by the computerized electronic auction payment system, prior to being deemed as winning bidders, via direct deposit, using a credit card, or sending a check, money order, or other financial document to an operator of the computerized electronic auction payment system. In one embodiment, upon being deemed as a winning bidder, the winning bidder accesses a payment page, enters the total amount of funds to be transferred to the seller, and authorizes the computerized electronic auction payment system to effect a real-time payment by debiting his, i.e., the winning bidder's, respective electronic auction payment account and crediting the electronic auction payment account of the seller, and / or another account specified by the seller. In an alternate embodiment, the prospective bidder authorizes the computerized electronic auction payment system to effect a real-time payment to the seller upon the prospective bidder being deemed the winning bidder (i.e., immediately following the conclusion of the auction). That is, without the winning bidder having to access the payment page.

Owner:XPRT VENTURES

Method and apparatus for conducting electronic commerce transactions using electronic tokens

Methods and apparatus for conducting electronic commerce using electronic tokens are described. The electronic tokens are issued and maintained by a vendor, who also provides products and services that can be purchased or rented using the electronic tokens. The electronic tokens may be purchased from the vendor either on-line, using a credit card, or off-line, using a check, money order, purchase order, or other payment means. Because the vendor is the issuer of the electronic tokens, there is no need for transactions to be handled by a third party, such as a bank or other organization. This reduces the overhead involved in conducting electronic commerce, and provides the vendor with a greater amount of control. Additionally, the vendor maintains total control over the price of the electronic tokens at any time. For vendors who offer software products for sale or rental, use of electronic tokens makes a variety of rental arrangements practical. Additionally, a user registers and purchases electronic tokens at the vendor. The user may purchase products at any other vendors who conduct electronic commerce using electronic tokens.

Owner:AML IP LLC

Automated banking machine

An automated banking machine (10) includes a user interface (12) including an opening (20). Users of the machine deliver individual sheets and stacks of sheets to and from the machine through the opening. Stacks of sheets may include sheets such as notes, checks or other documents. Stacks input to the machine may include mixtures of various types of sheets. The machine operates to receive notes, process checks and perform other operations. Notes received in the machine may be recycled and dispensed to other users. Checks processed by the machine may be imaged by an imaging device, cancelled and stored in the machine or alternatively returned to a user. Documents produced by the machine such as receipts, checks or money orders as well as notes dispensed from the machine are assembled into a stack within the machine and delivered from the machine through the opening.

Owner:DIEBOLD NIXDORF

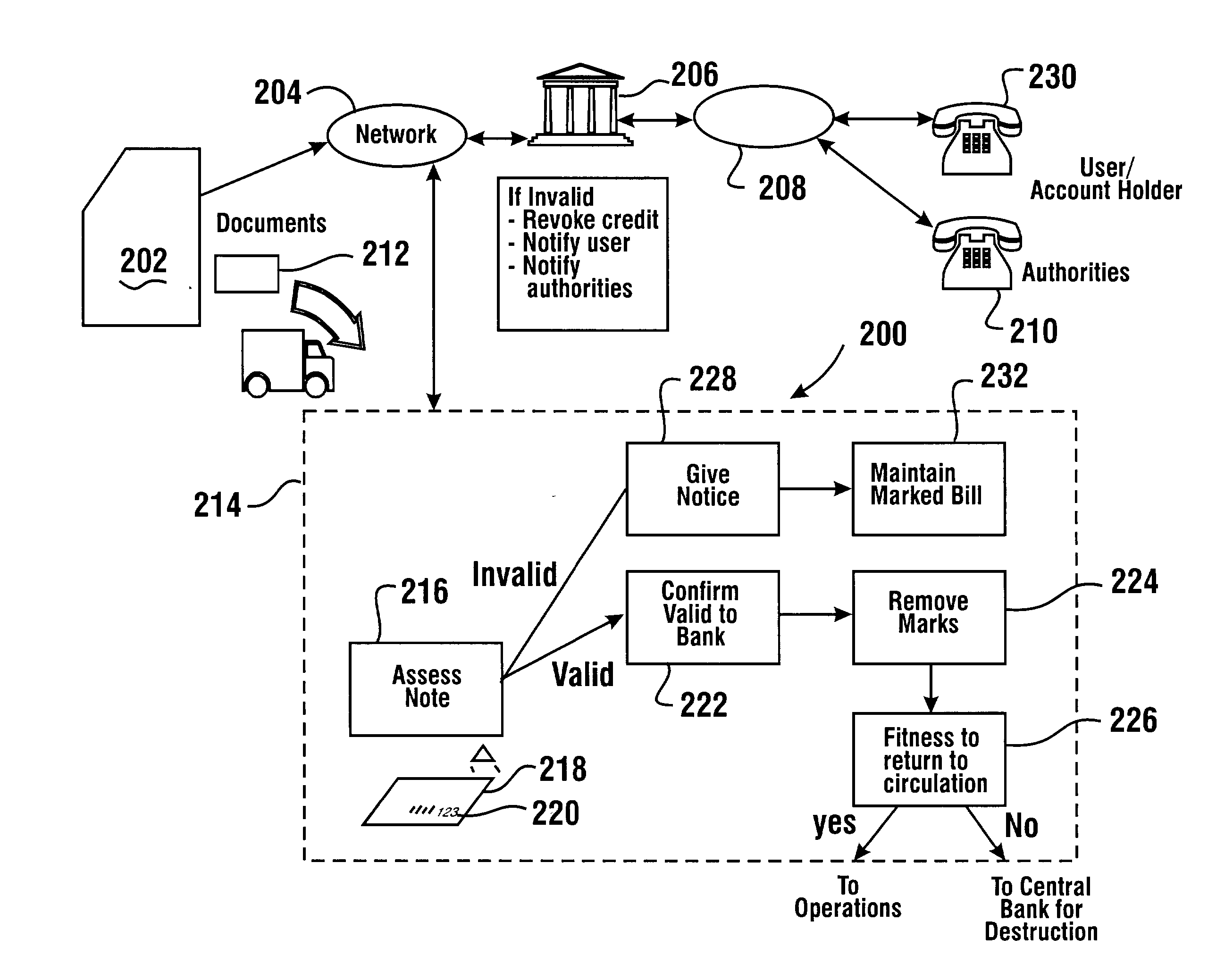

Storing information concerning suspect currency notes received in an ATM

InactiveUS6783061B2Simpler customer interfaceReduce physical sizePayment architectureSortingEngineeringCheque

Owner:DIEBOLD NIXDORF

Wireless electronic check deposit scanning and cashing machine with web-based online account cash management computer application system

Wireless Electronic Check Deposit Scanning and Cashing Machine (also known and referred to as WEDS) Web-based Online account cash Management computer application System (also known and referred to as OMS virtual / live teller)—collectively invented integrated as “WEDS.OMS” System. Method and Apparatus for Depositing and Cashing Ordinary paper and / or substitute checks and money orders online Wirelessly from home / office computer, laptop, Internet enabled mobile phone, pda (personal digital assistant) and / or any Internet enabled device. WEDS enables verification and transmittal of image, OMS is the navigation tool used to set commands and process requests, integrated with WEDS, working collectively as WEDS.OMS System.

Owner:USAA

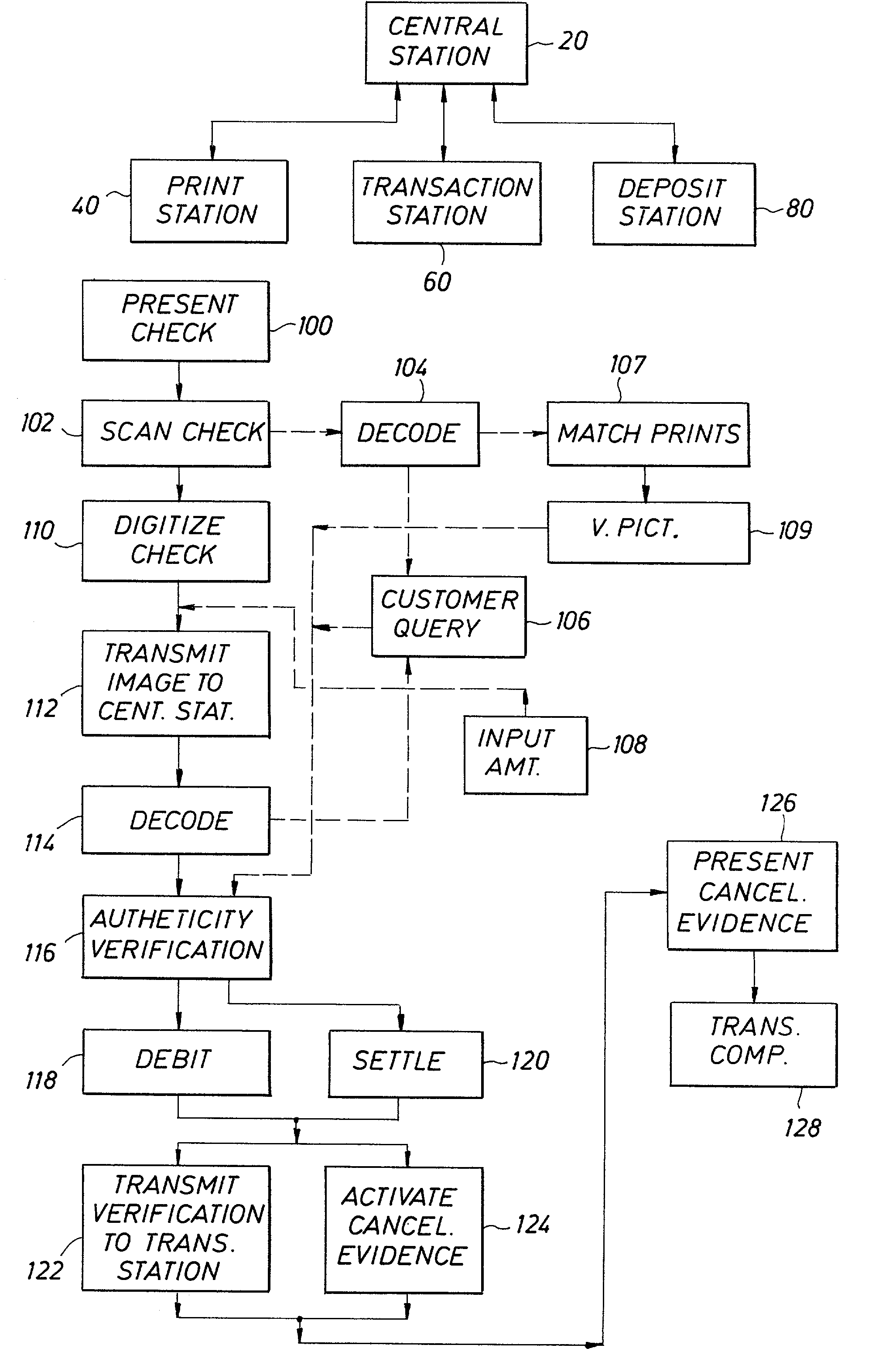

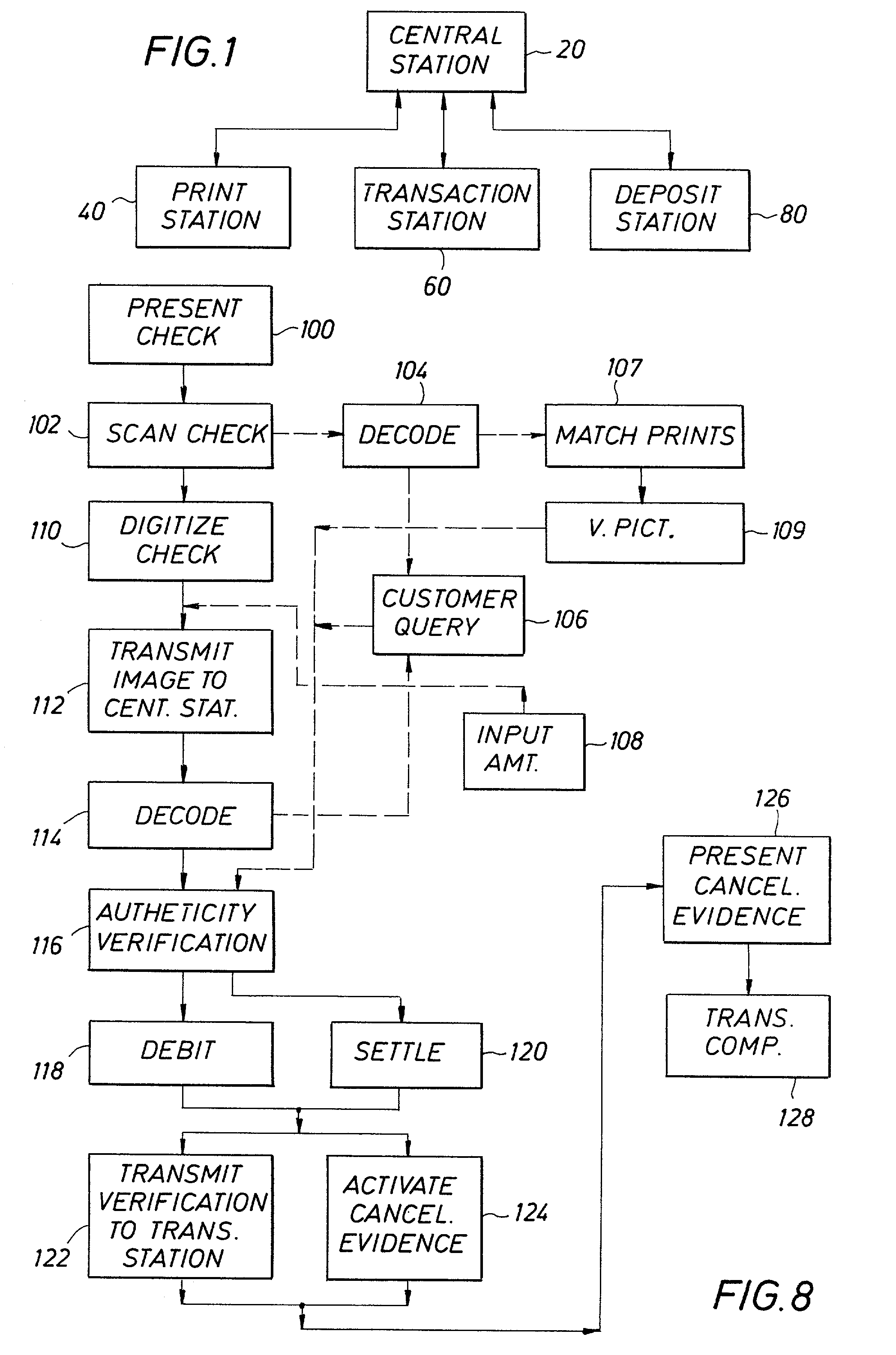

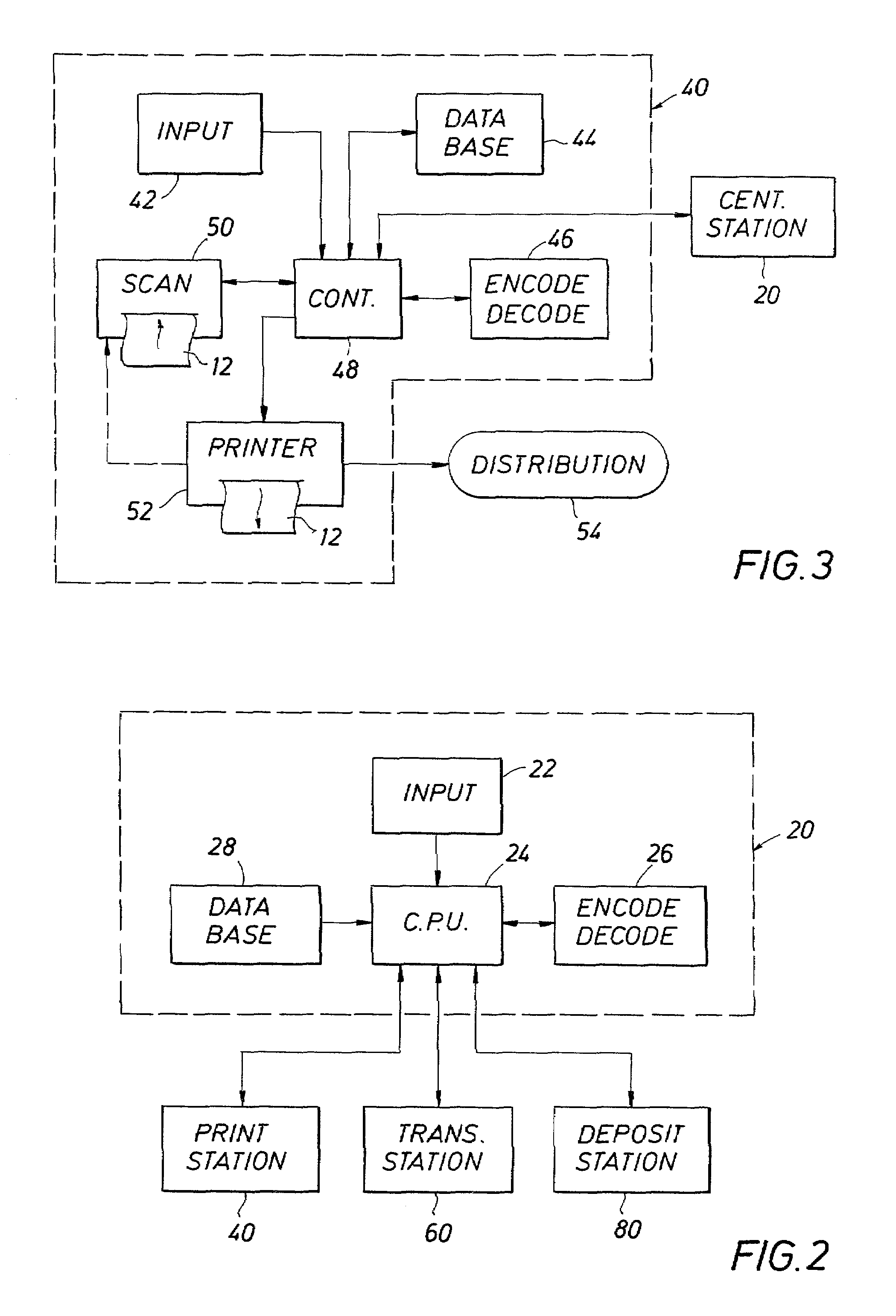

System for authenticating and processing of checks and other bearer documents

A bearer document processing system includes preparation, verification, redeeming and depositing of the document. An encrypted symbol is imprinted on the document using ink that is not visible in invisible light. The symbol includes information used to authenticate the document and to identify the bearer of the document. The document is scanned at a transaction point. The symbol can be decoded at transaction points or at a remote central processing station. Accounts involved in transactions are credited and debited using information contained in the encoded symbol and other information provided by the bearer and the acceptor of the document. Transactions are performed in essentially real-time, and the bearer is provided with evidence of a successful transaction. Although applicable to any type of bearer document such as stock certificates, money orders, the system is particularly applicable to processing bank checks in real-time and with the possibility of fraudulent transactions being minimized.

Owner:MOORE LEWIS J

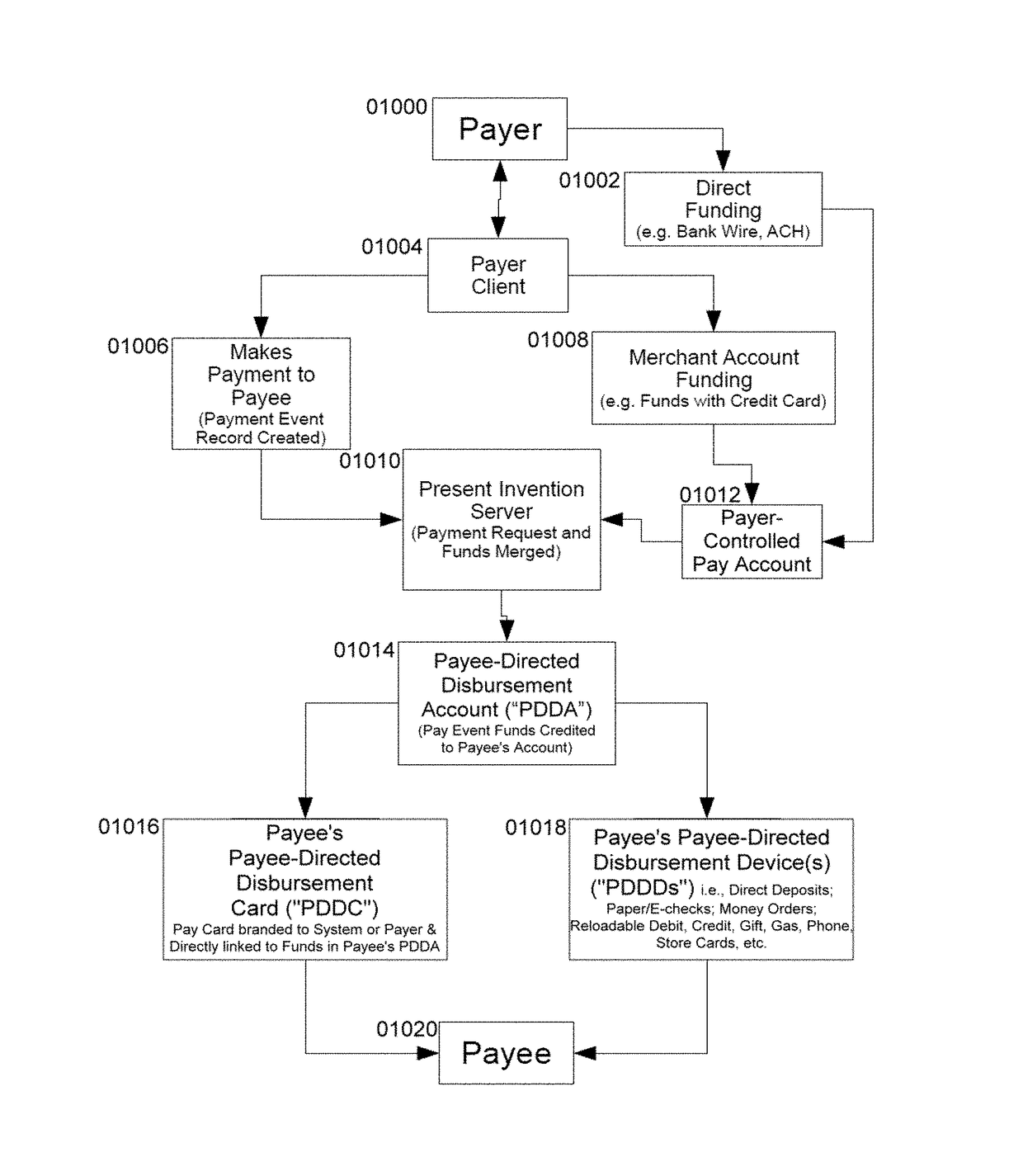

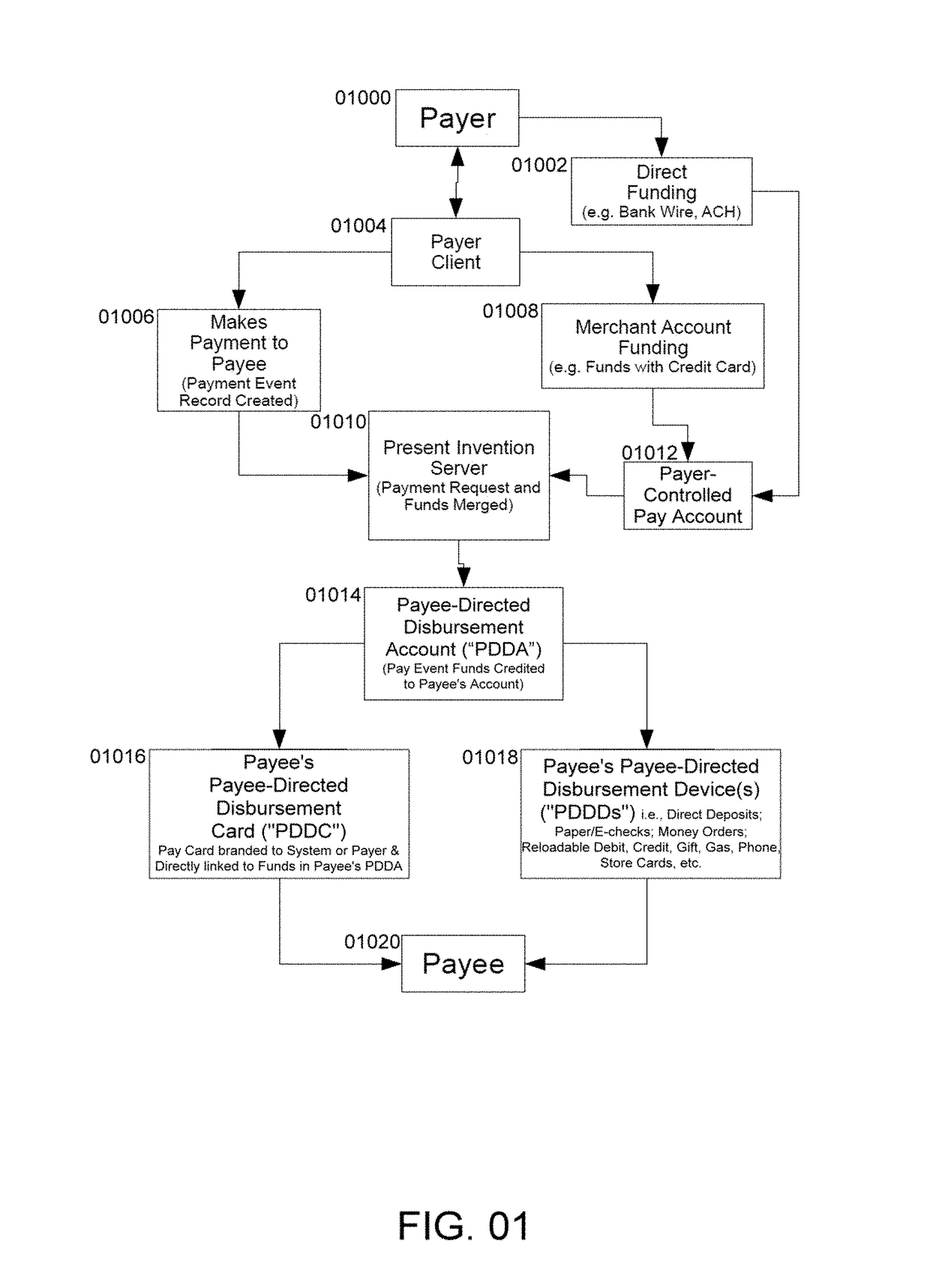

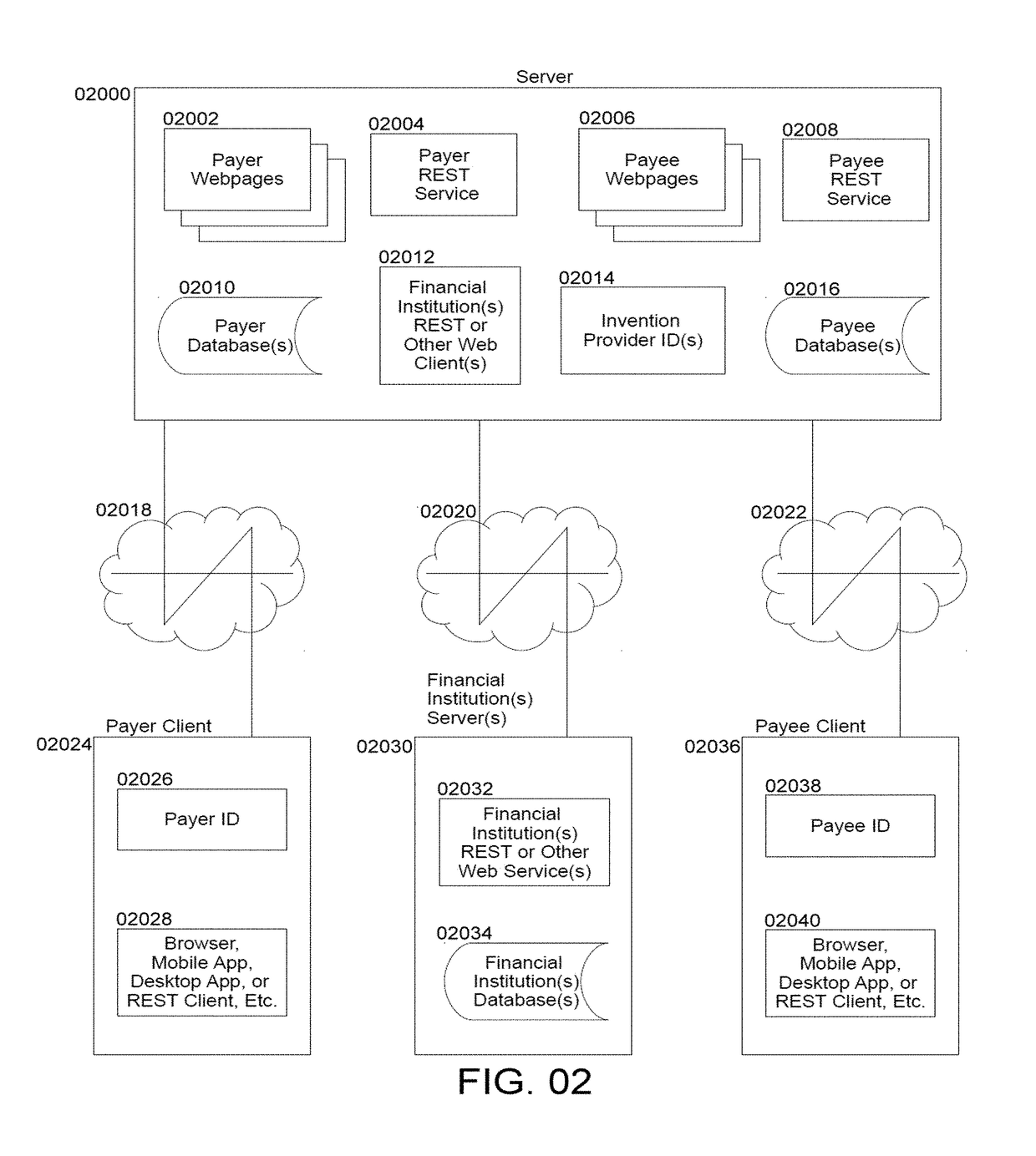

Private Payee-Controlled Compensation Disbursement System to Multiple Payee Directed Disbursement Devices

InactiveUS20170178110A1Simplify the fulfillment of their Payment Event obligationsExpand accessPayment schemes/modelsProtocol authorisationClient server systemsTelephone card

Present Invention enables non-cash-paid workers / vendors to rapidly receive net or gross compensation for rendered services / products with or without personal access to banking—unlimited by time and volume restrictions currently imposed by private label pay cards and systems. Present invention is a method, via a client server system, by which a Compensation Payer can issue individual or bulk funds to a secure Payer account—accompanied by (a) payment manifest(s)—which automatically and verifiably distributes to Payee-controlled accounts from which Payees can privately direct some or all of the received compensation to multiple Payee-Directed Disbursement Devices, including, without exclusion of others, direct deposit, paper / e-checks, money orders, and virtually any kind, number, and combination of verifiably legitimate debit, credit, gas, phone, gift, or store cards, prioritized, among others, by card, card type, and dollar amounts at Payee's directions received prior to or anytime after a specific payout disbursement.

Owner:SWANSON DAVID BENJAMIN +2

System and method for effecting payment for an electronic auction commerce transaction

Owner:XPRT VENTURES

Method and system for secure authenticated payment on a computer network

InactiveUS20050246290A1Simple, secure and easy-to-deployKey distribution for secure communicationUser identity/authority verificationDigital signatureThe Internet

A simple, secure and easy-to-deploy method and system for authenticating credit and debit cardholders at the point-of-sale on a computer network (e.g. the Internet) is disclosed. Cardholders are authenticated using digital signatures on a sales draft, in a manner that does not necessarily require any changes in the transaction flow of the participating financial institutions.

Owner:CA TECH INC

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com