Patents

Literature

167 results about "Electronic funds transfer" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

Electronic funds transfer (EFT) are electronic transfer of money from one bank account to another, either within a single financial institution or across multiple institutions, via computer-based systems, without the direct intervention of bank staff.

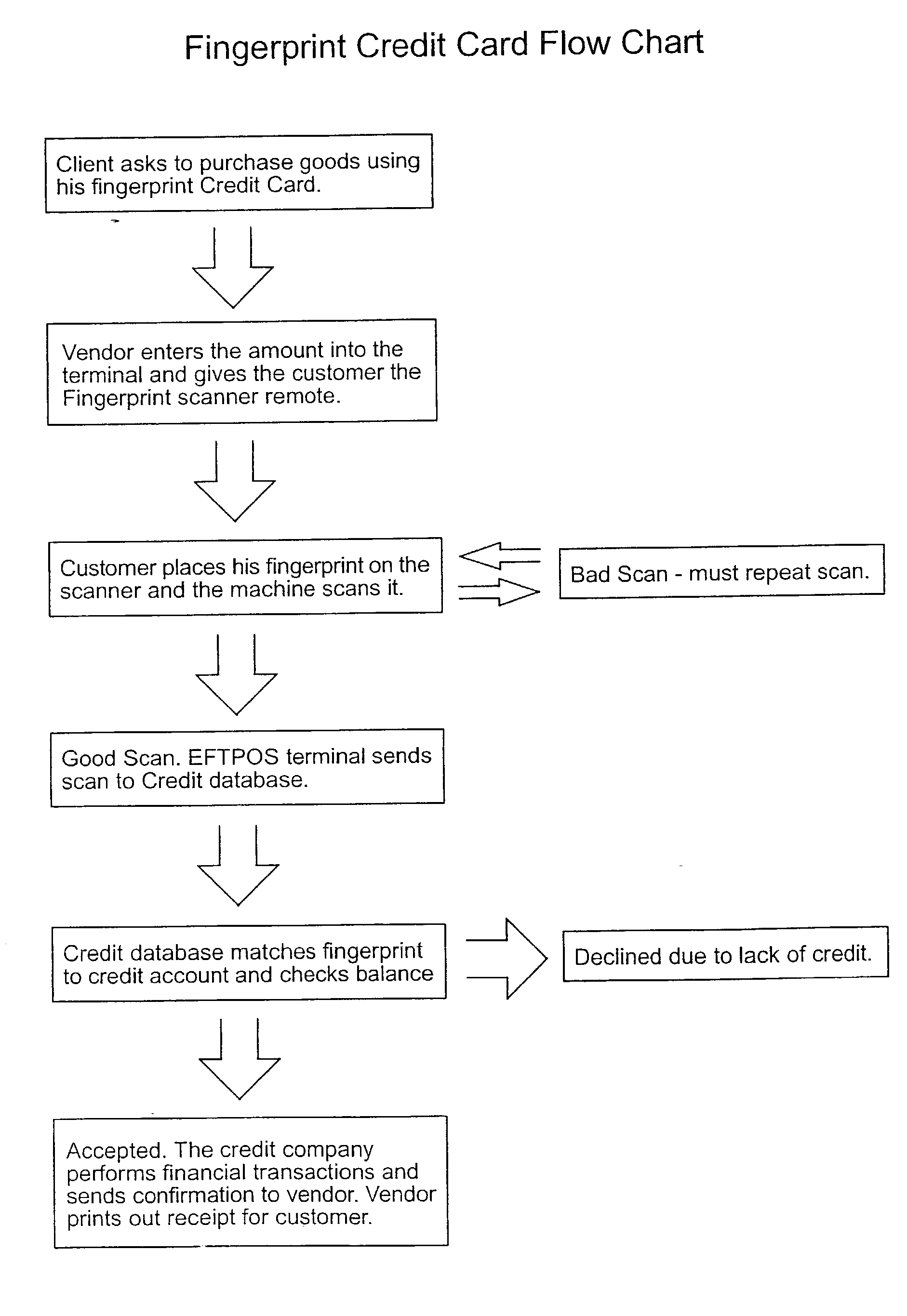

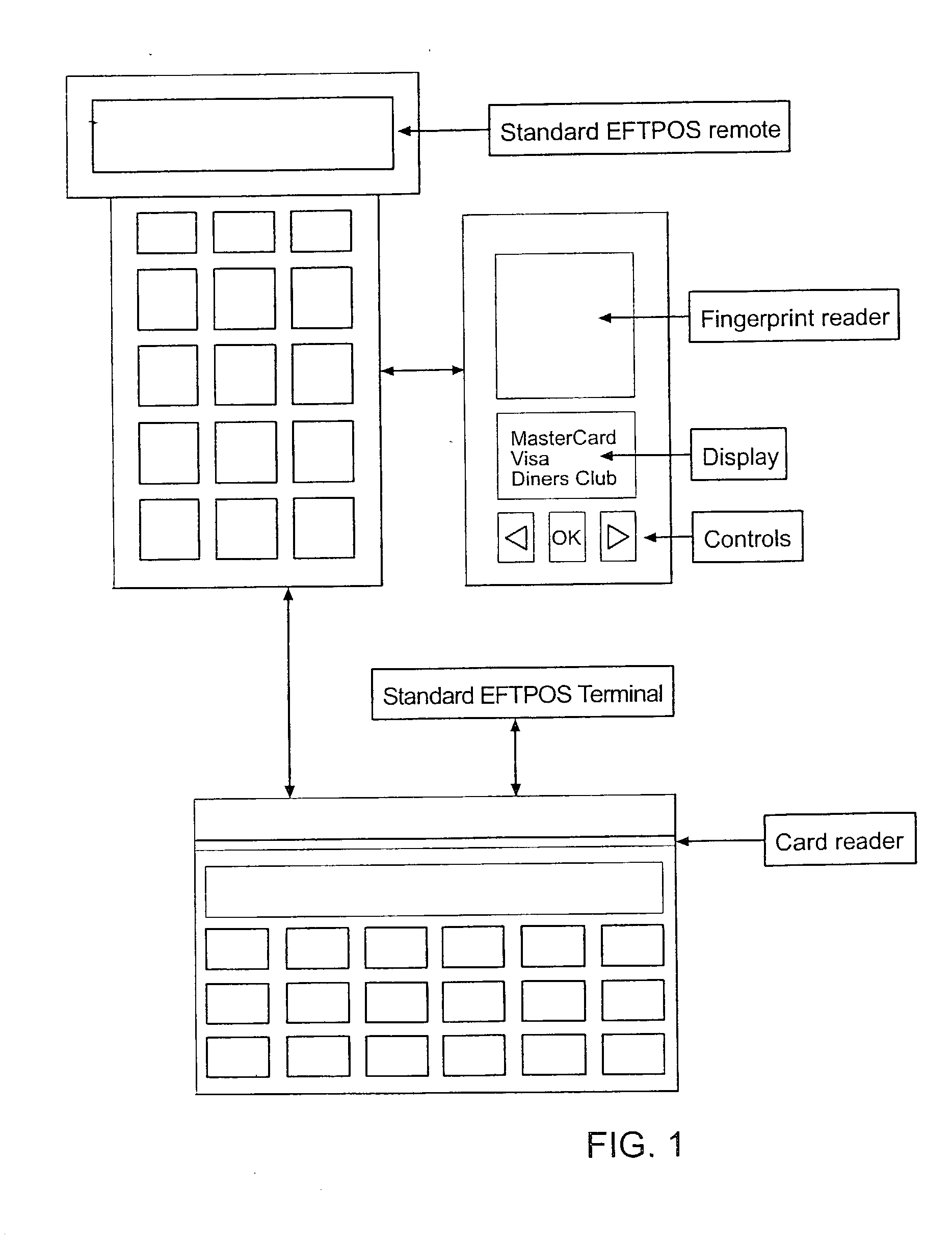

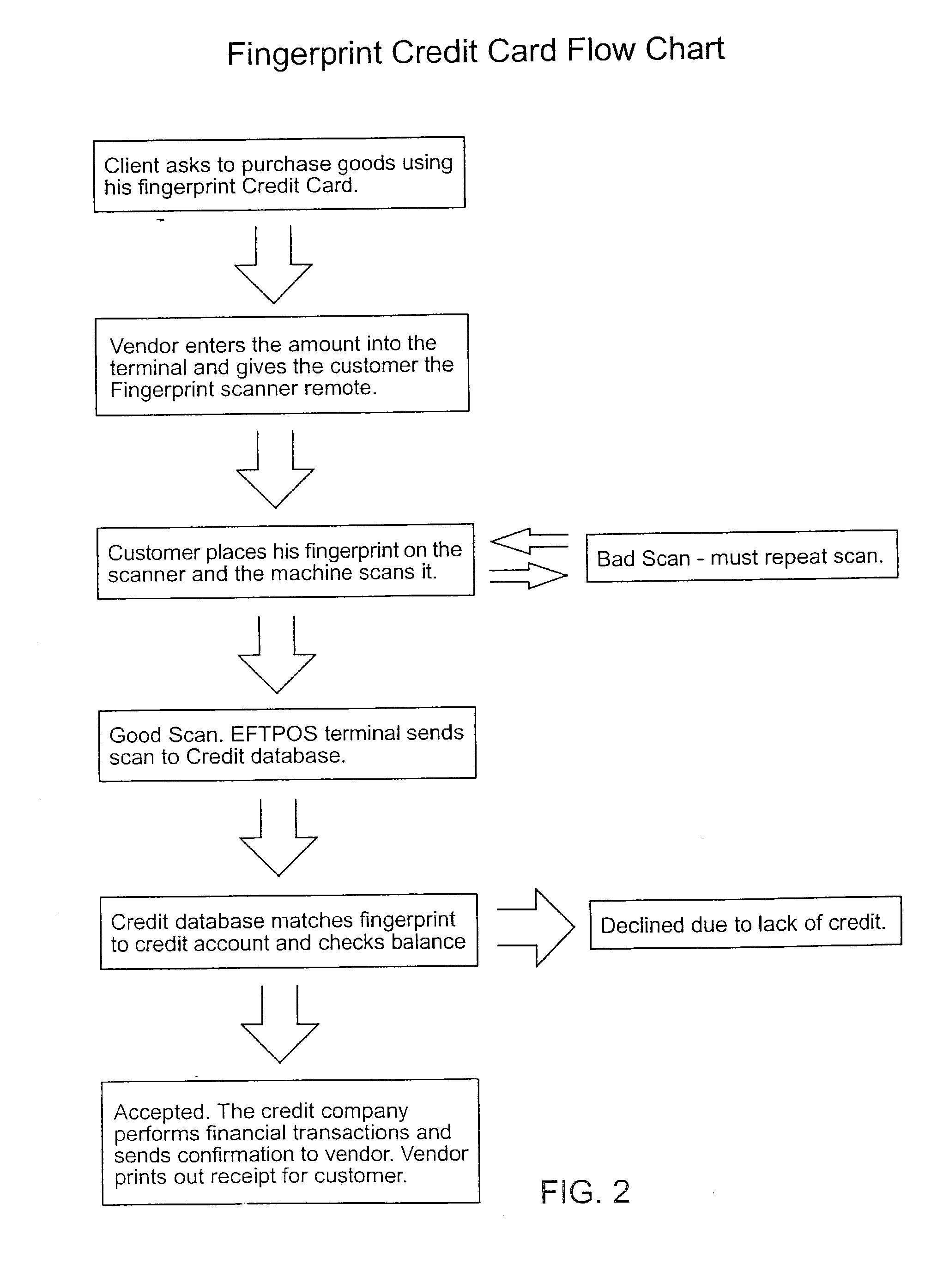

Method and apparatus for authenticating financial transactions

A system for authentication of financial transactions using a remote terminal includes apparatus for sampling a unique biological identifier of a system user. The system has particular relevance to credit card or other electronic funds transfer transactions whereby the user may complete a transaction over the Internet, or at a merchant's remote terminal by using a unique biological identifier in place of the credit card. The unique biological identifier is preferably a finger print which is read by a camera at the personal computer or remote terminal. The image is digitized and forwarded to a clearing house to identify the appropriate account for the required transaction to be processed.

Owner:ELECTRONICS FINGER PRINT TECH

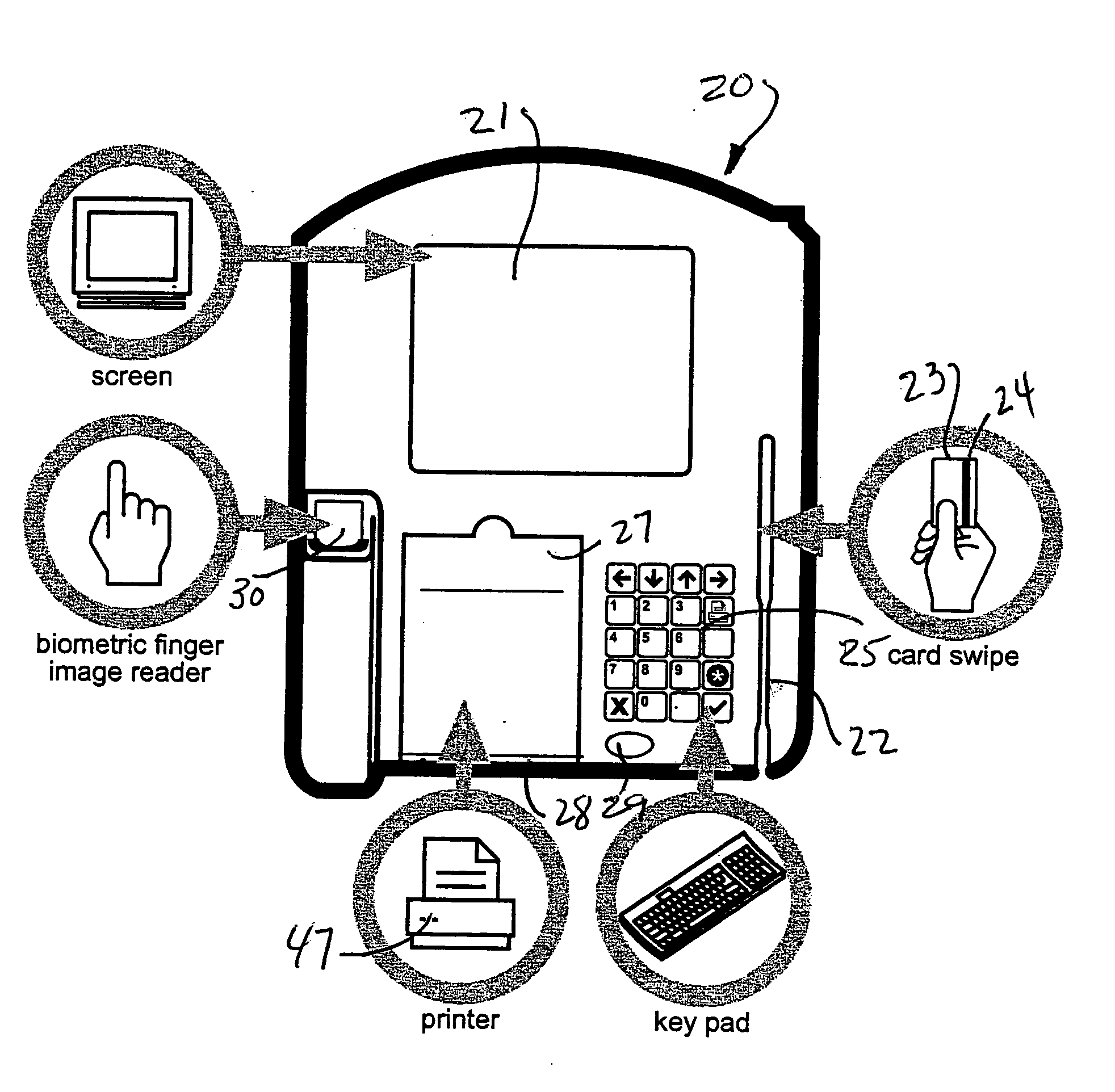

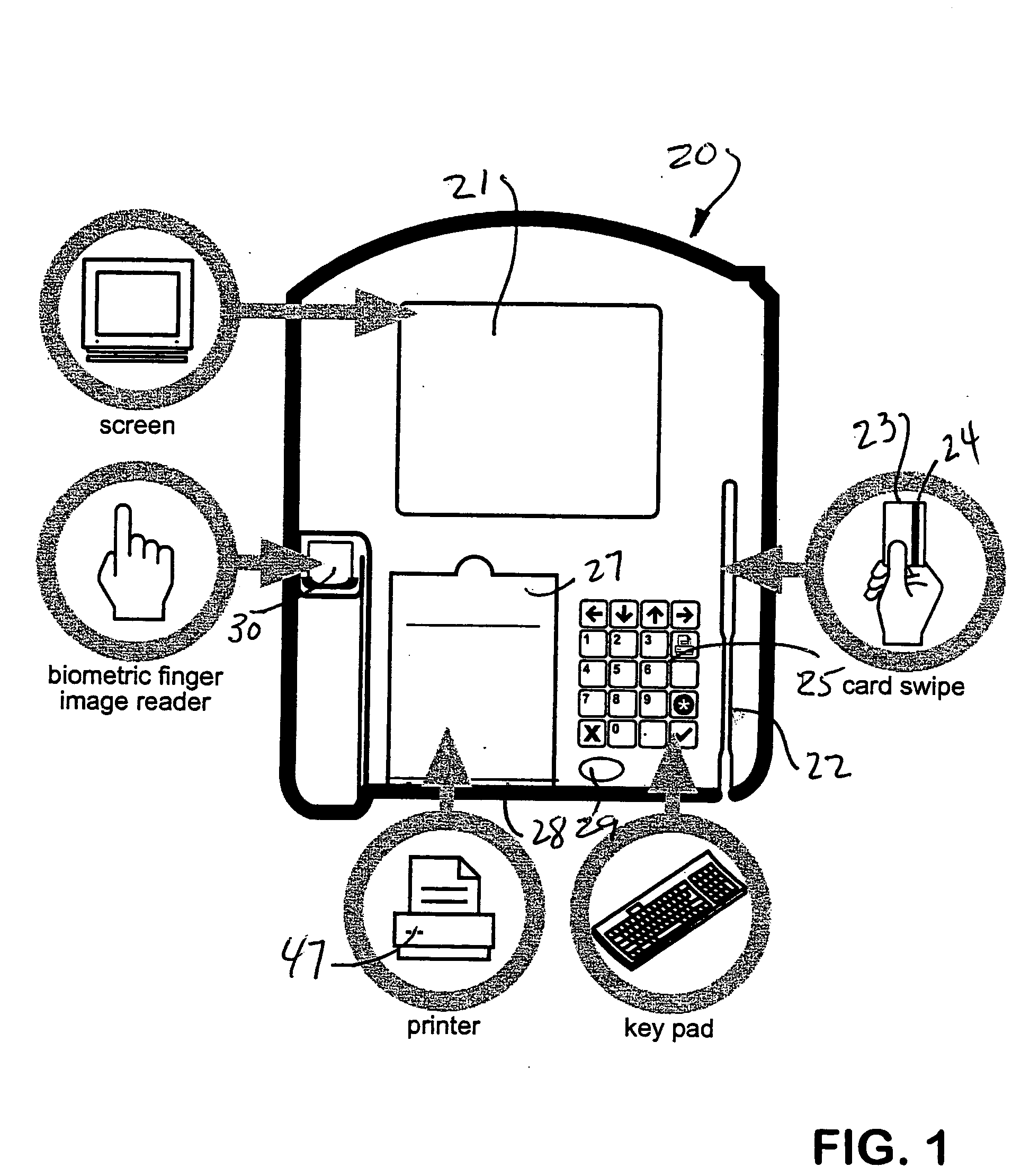

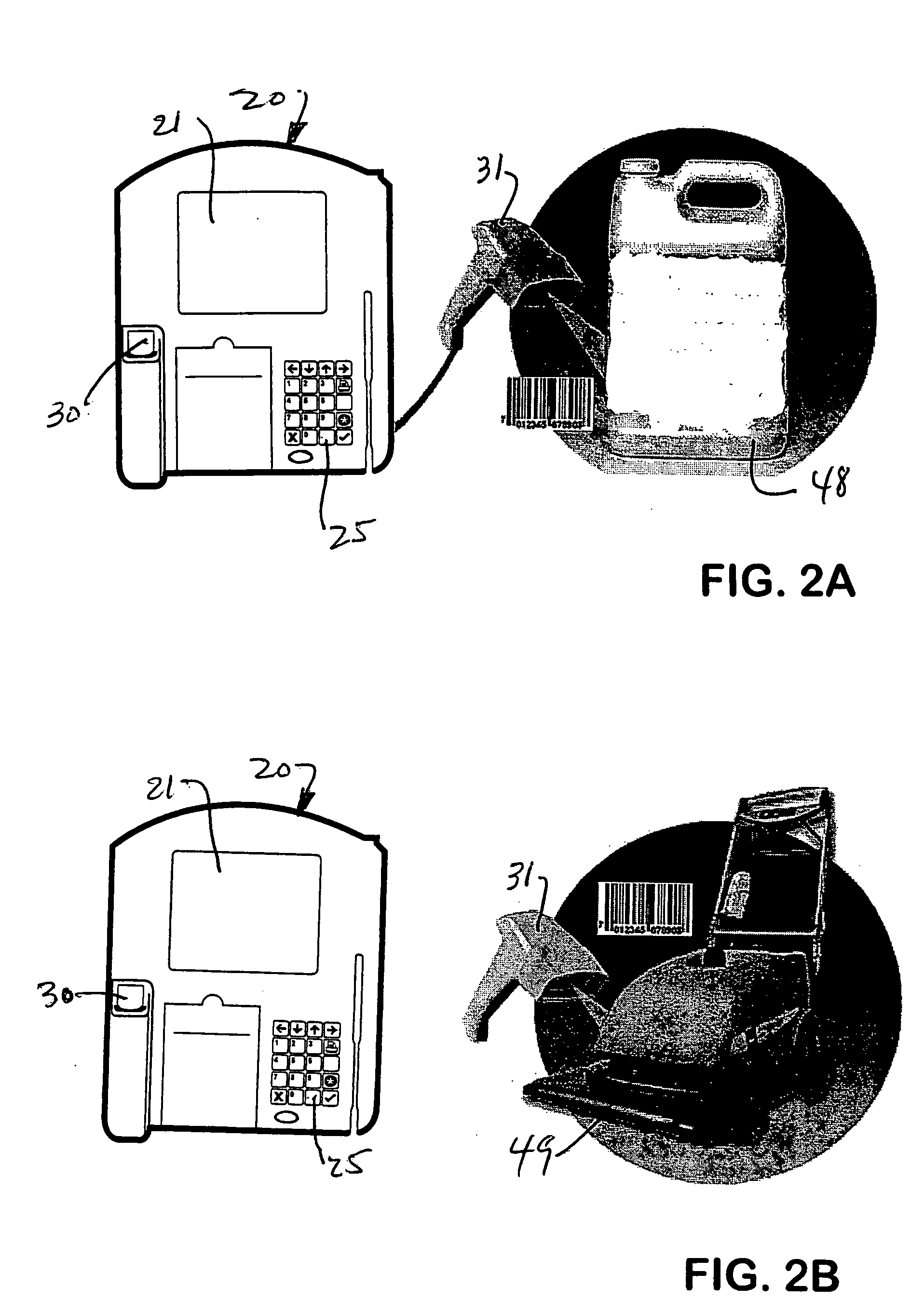

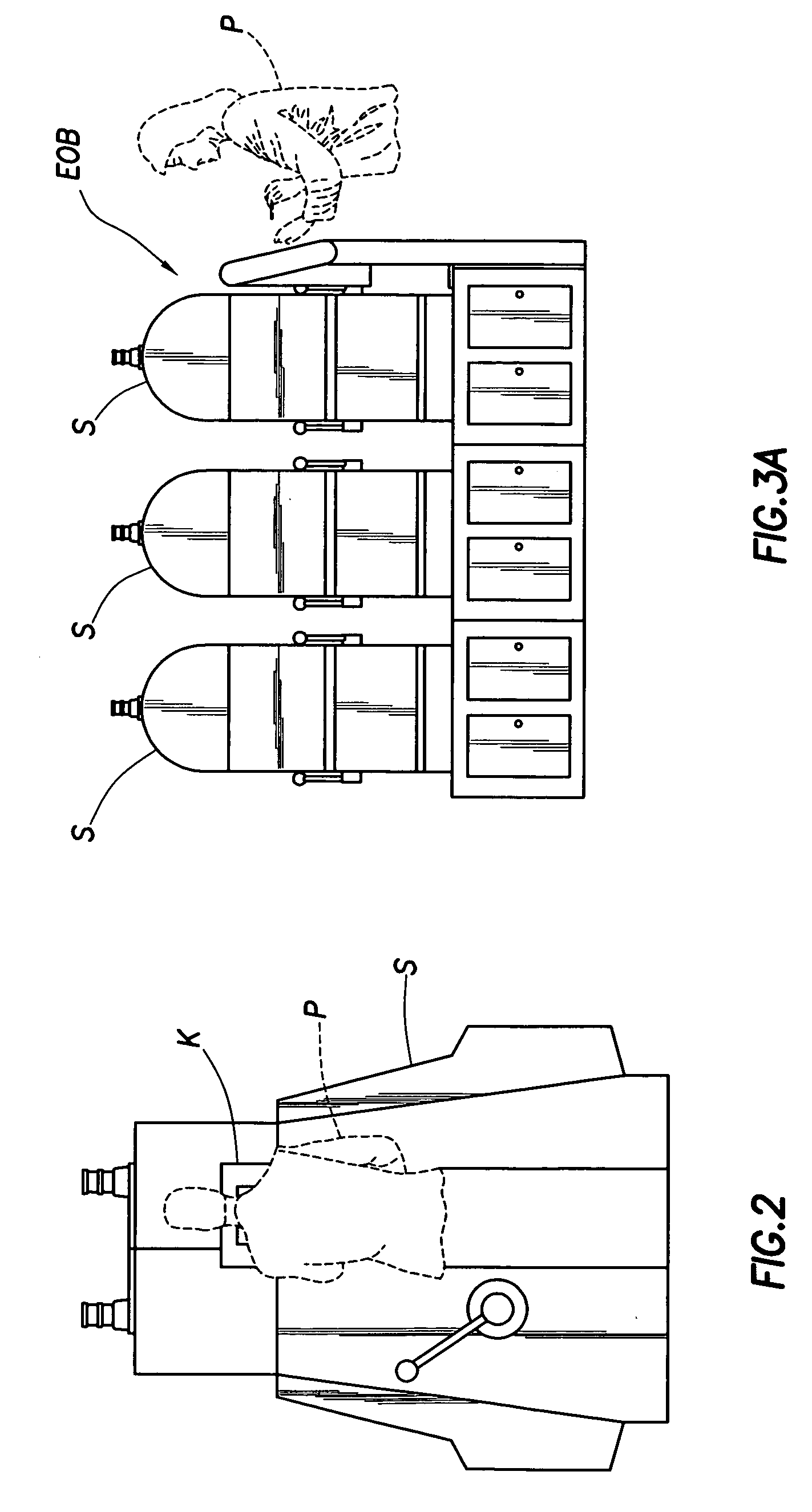

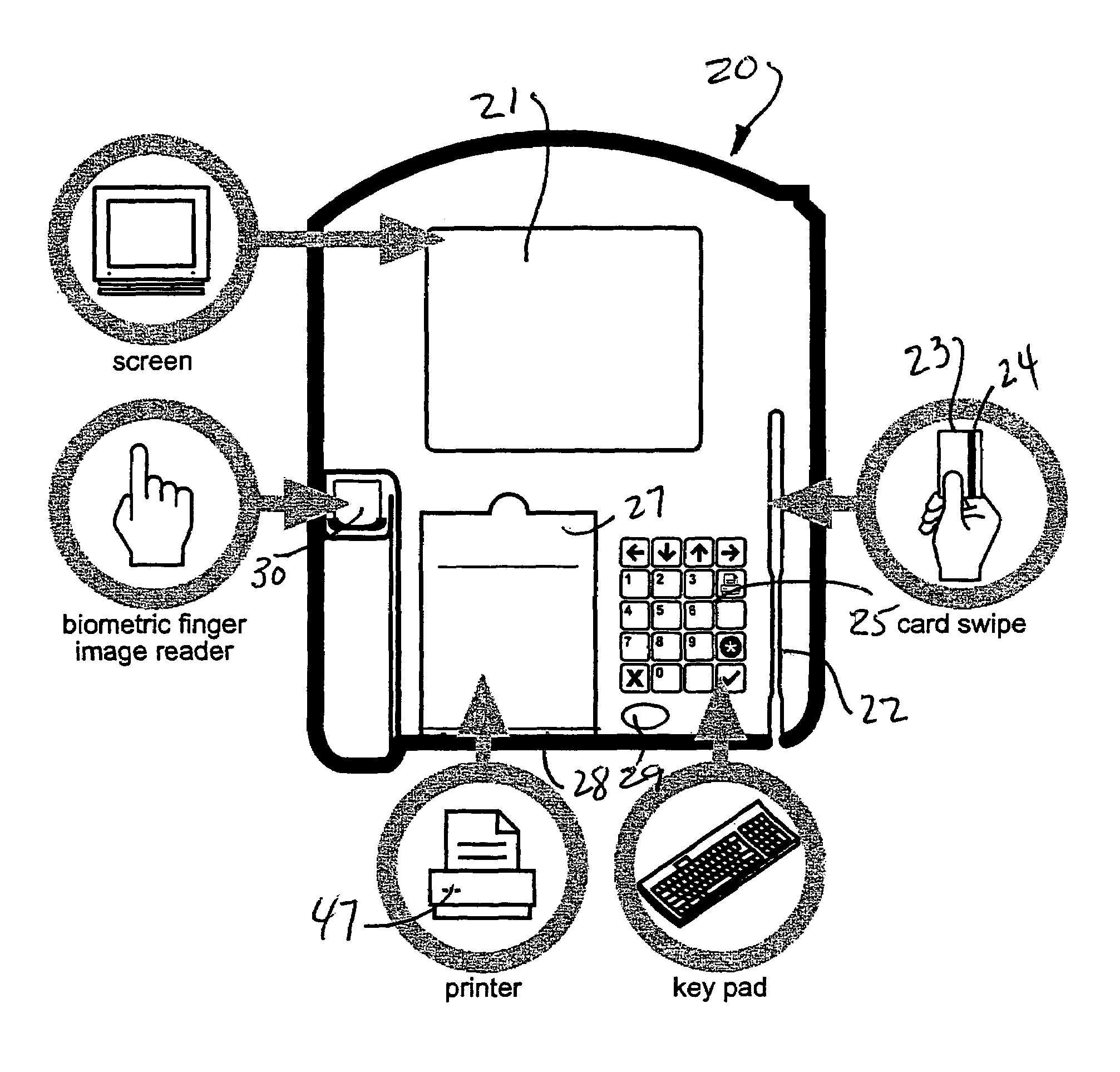

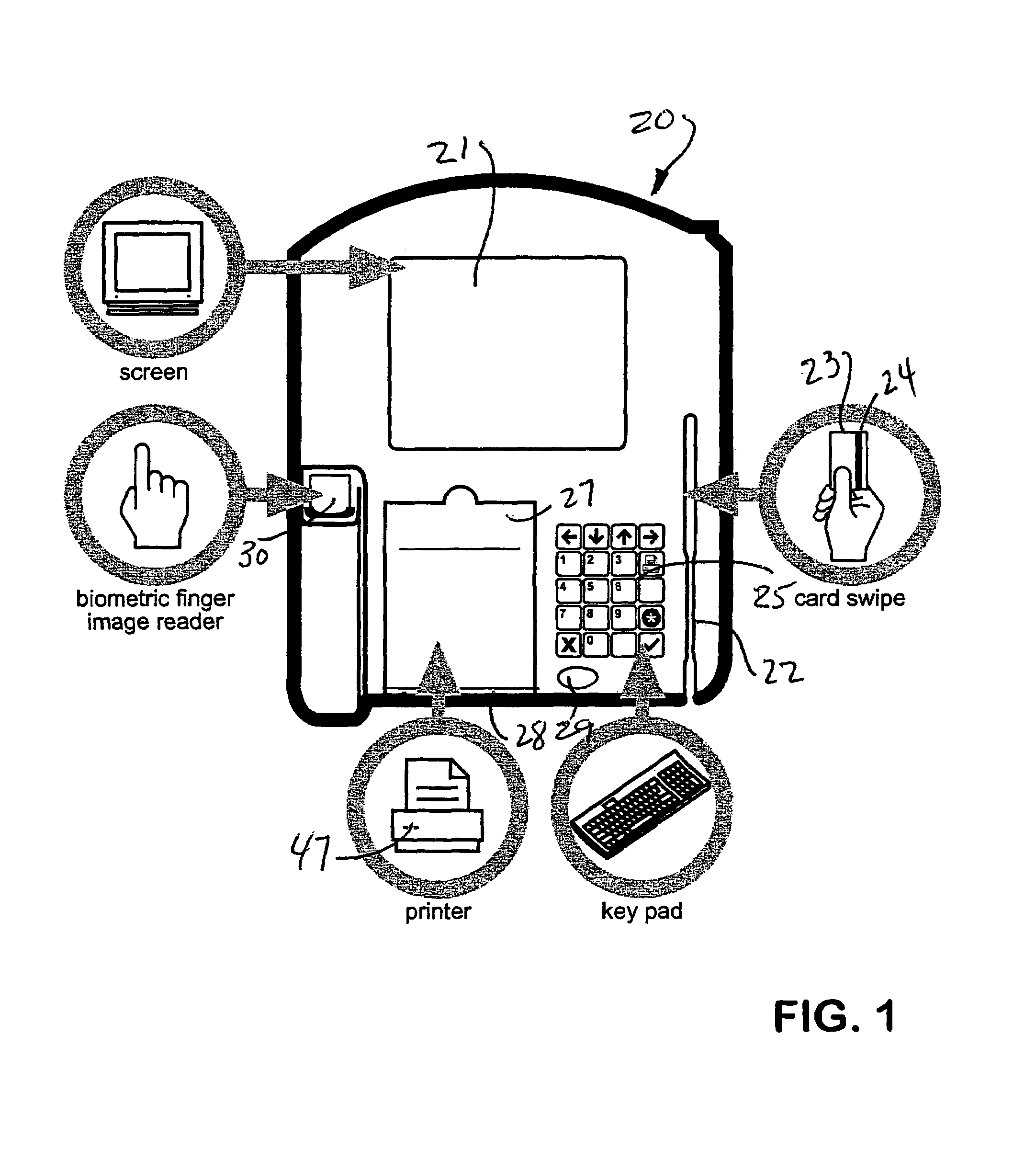

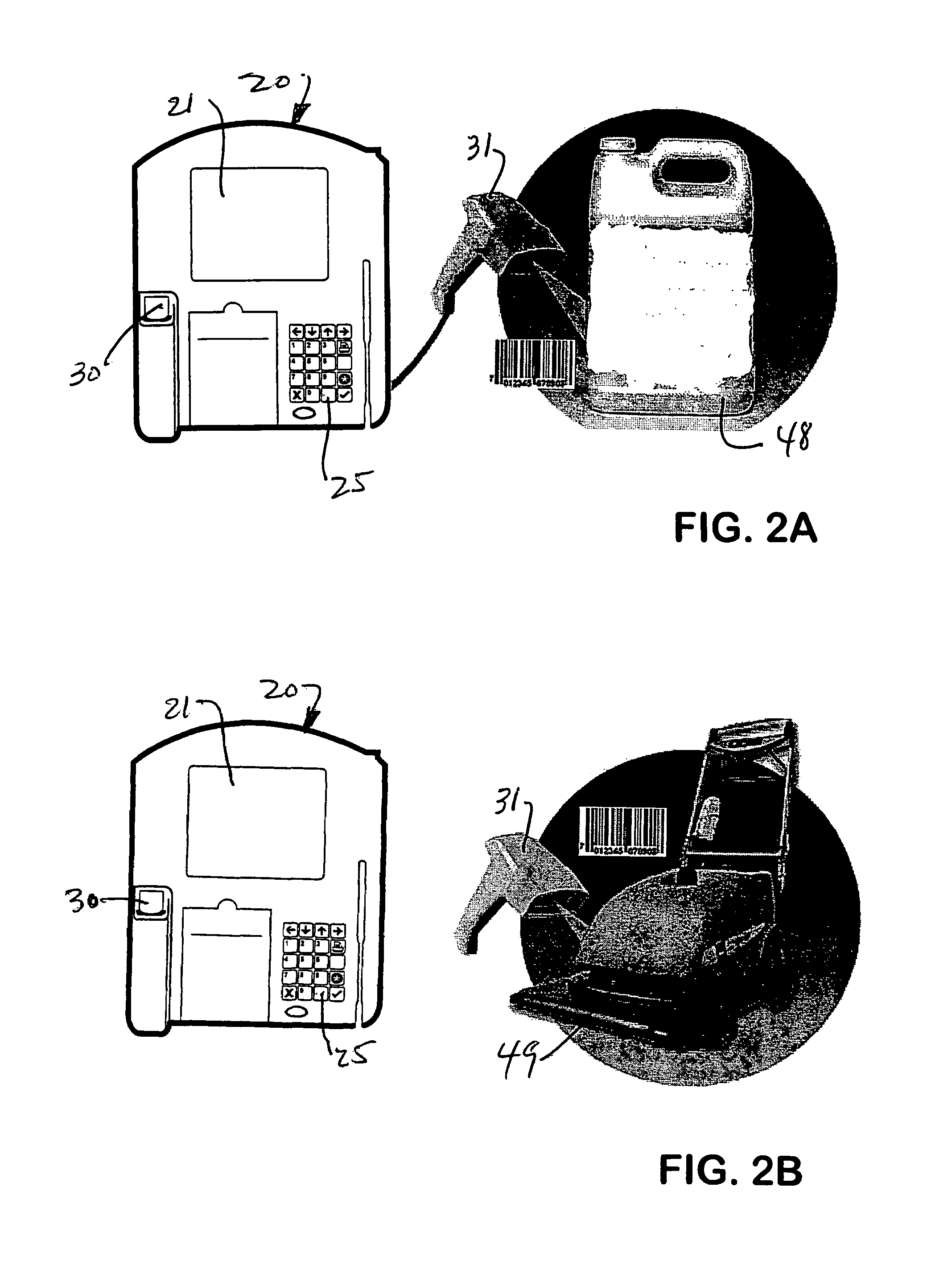

Biometric multi-purpose terminal, payroll and work management system and related methods

InactiveUS20050109836A1Efficient use ofAssist in managementRegistering/indicating time of eventsFinancePersonal identification numberBank account

Employees gain access to a payroll and work management system by authentication at a multi-purpose terminal with a bankcard encoded with a unique account number and a personal identification number (PIN). The terminal may then be used to check-in and checkout of work, to receive new work instructions or assignments, to review payroll details, to print a payroll stub, to execute financial transactions, to print a receipt of financial transactions or to review or to upload the results of work quality audits. The invention also includes systems and methods that utilize such multi-purpose terminals to calculate the payroll and deductions for each employee and to issue electronic fund transfers from the employer's bank account to deposit the net pay in a bank account associated with each employee's bankcard so that the pay is immediately accessible by each employee, such as by withdrawal of cash at an ATM or by purchases at a point of sale. Electronic payrolls may be processed and employee's accounts credited with pay on a daily basis, or on any preset period of time, including hourly.

Owner:AMERICAN EPS

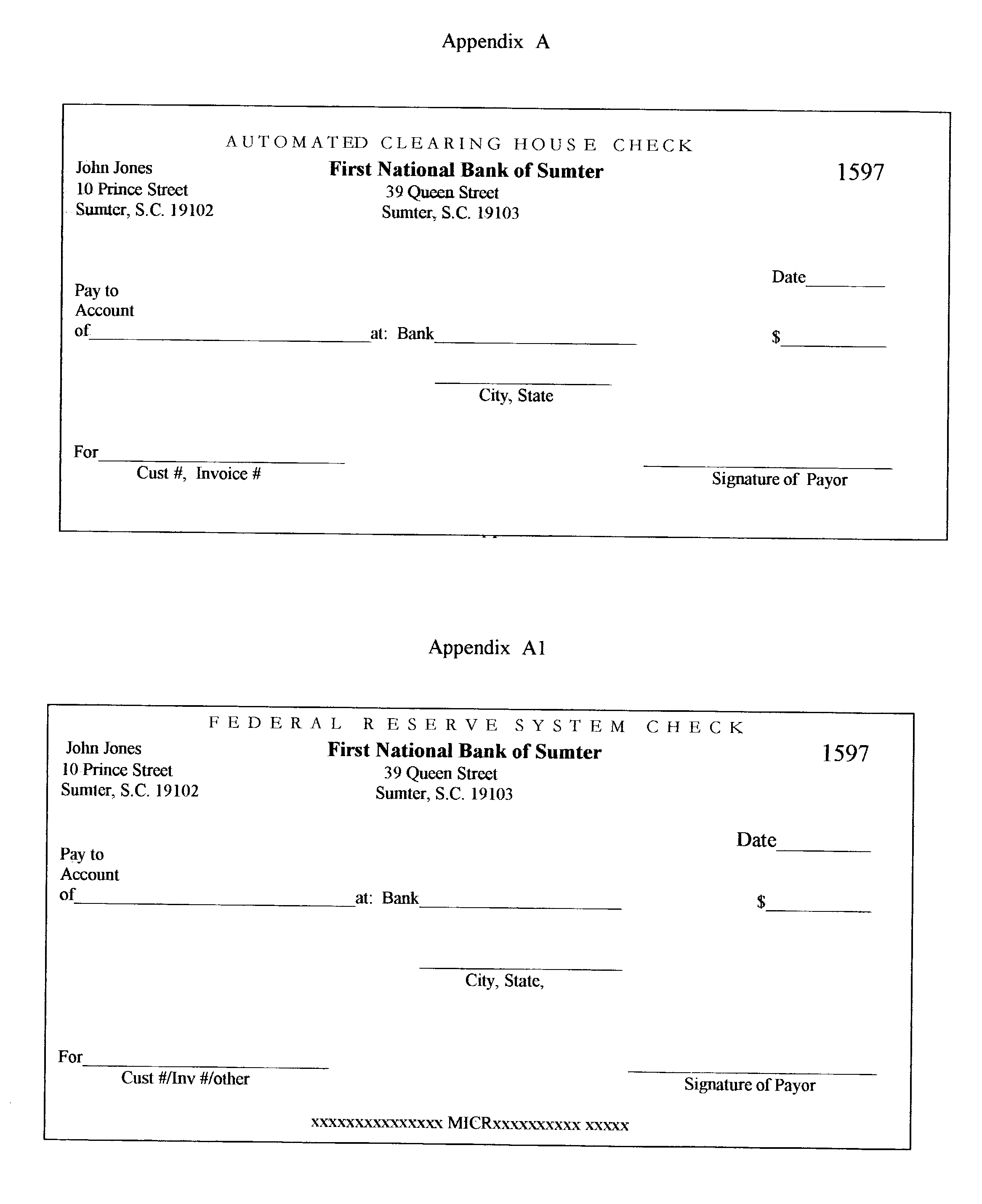

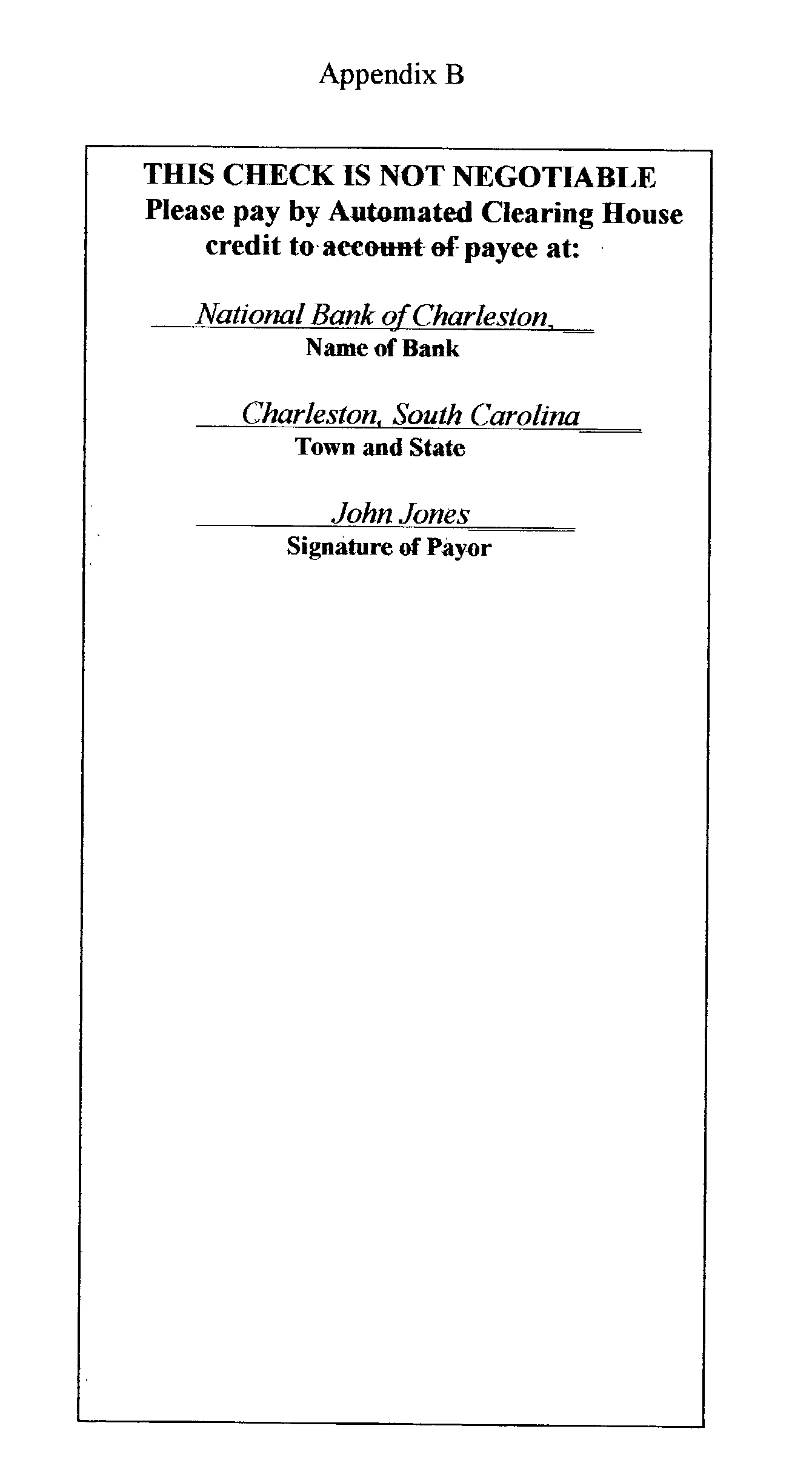

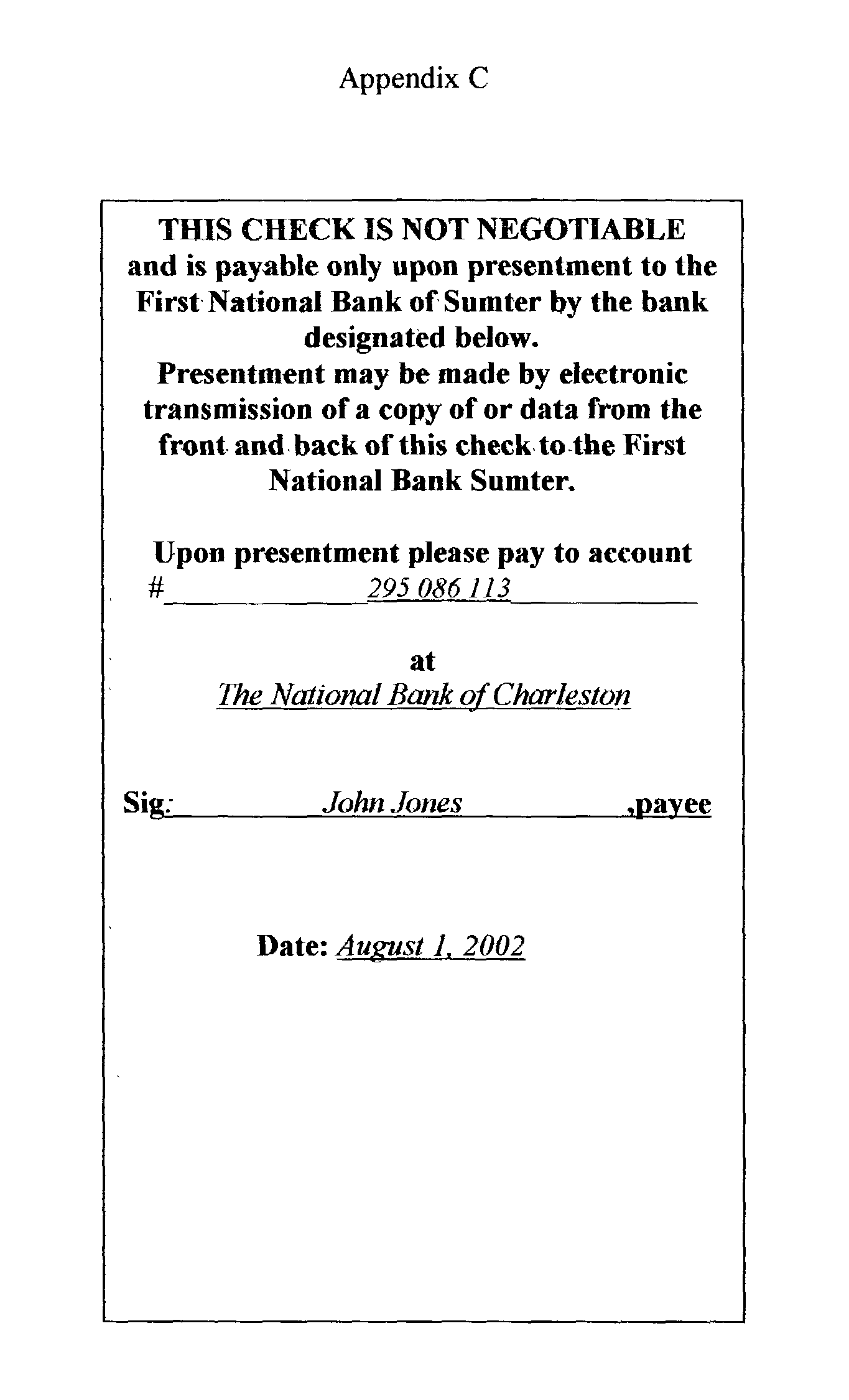

Method of making money payments

The system disclosed is for making payments using a new type of bank check combined with electronic funds transfer (EFT) facilities The new type check is not a negotiable instrument and is intended for delivery to the payor's bank rather than to the payee. The check instructs the payor's bank to make a payment by EFT from the payor's bank account directly to the bank account of the payee at the payee's bank, normally via the Federal Reserve's Automated Clearing House (ACH) facility. The system includes means for making a true, but inoperative, copy of each check at the time the check is written. Other embodiments of the invention are special checks, which look like conventional checks, but on their reverse sides display printed matter stating that they are non-negotiable and are payable only pursuant to special procedures.

Owner:ALLAN FREDERICK ALEY

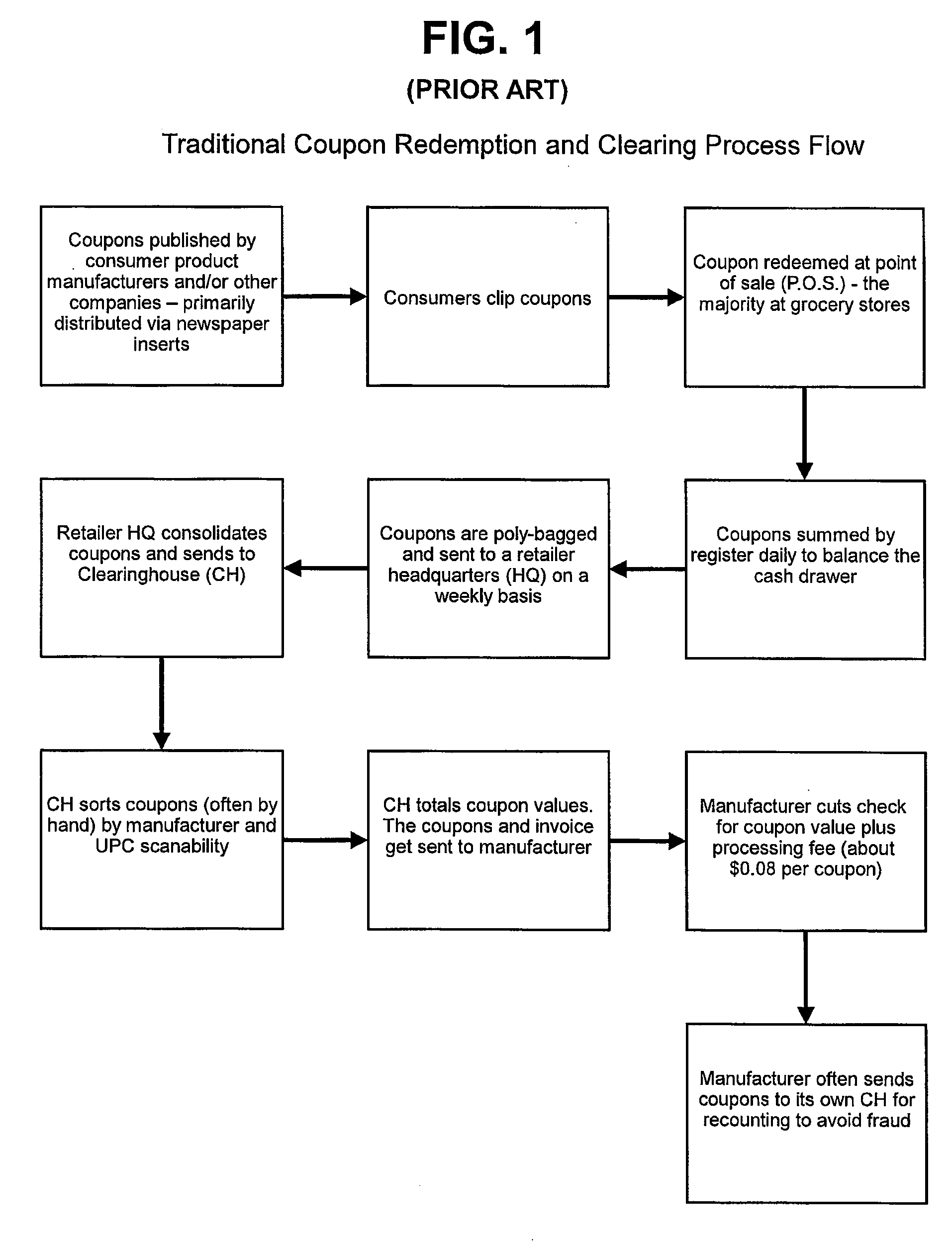

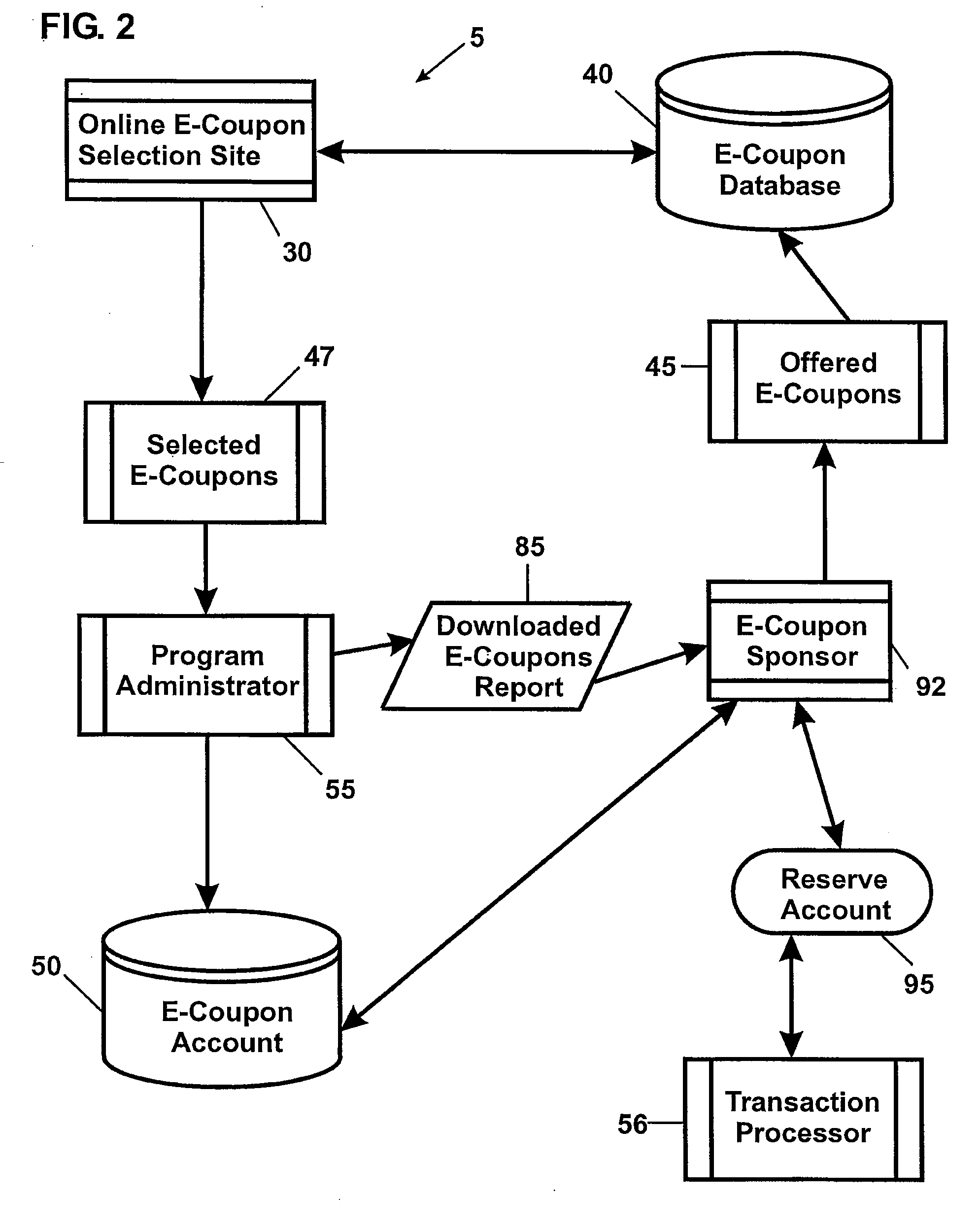

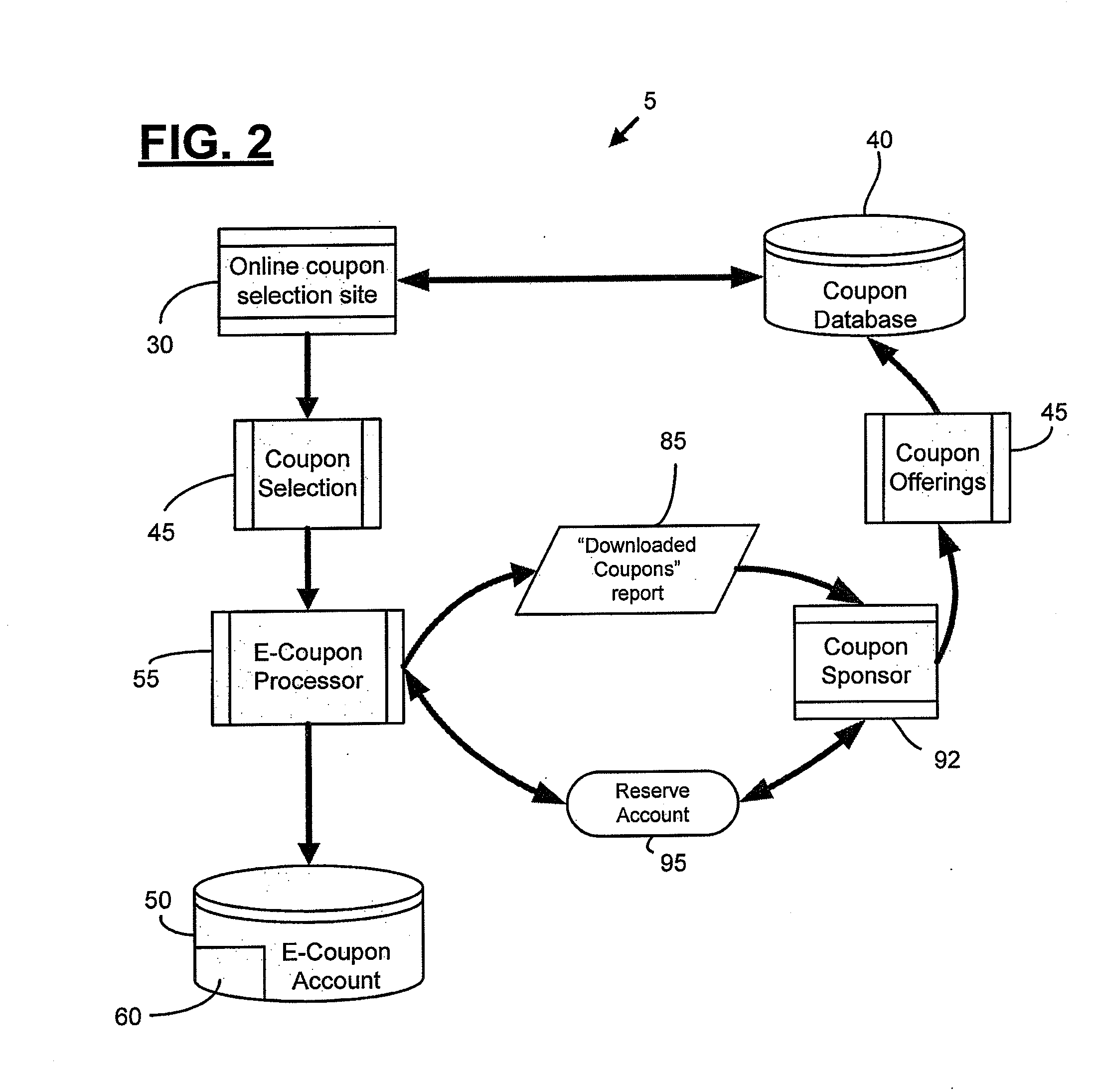

E-Coupon Settlement and Clearing Process

ActiveUS20090106115A1Opportunities decreaseShorten the construction periodComplete banking machinesFinanceComputer scienceElectronic funds transfer

A system that automates the clearing and settlement of electronic coupons (E-Coupons) by leveraging existing technologies and enabling E-Coupon redemption at any merchant having electronic funds transfer (EFT) capabilities, such as credit / debit card acceptance. The system reduces opportunities for fraud, reduces or eliminates the need for manual clearinghouse counting and sorting of coupons, and provides an electronic audit trail for coupon redemption, tying a specific purchase to a specific coupon. After registering and selecting coupons, consumers then use an E-Coupon card or account access device at a merchant's point-of-sale (POS) terminal. E-Coupon values are deducted from the consumer's final amount due. Both consumer package goods manufacturers (CPGs) and merchants may be charged a fee. Expired coupons are automatically removed from the account and their value refunded to the CPGs. Reports on redeemed coupons and consumer profiles can be generated and provided to CPGs or merchants.

Owner:FIDELITY INFORMATION SERVICES LLC

System and method for electronic deposit of third-party checks by non-commercial banking customers from remote locations

InactiveUS20050267843A1Level of independenceFinanceCo-operative working arrangementsThird partyCheque

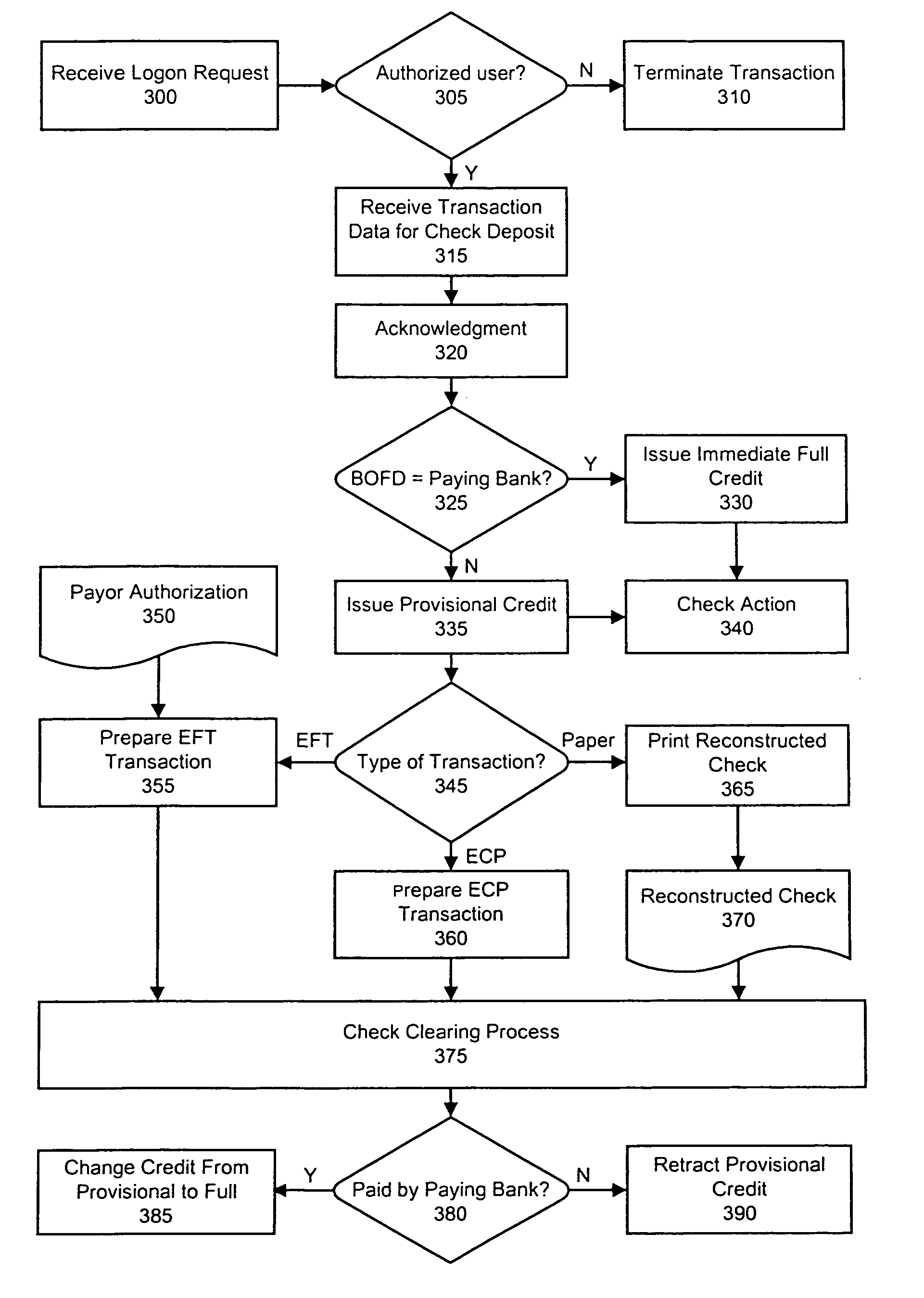

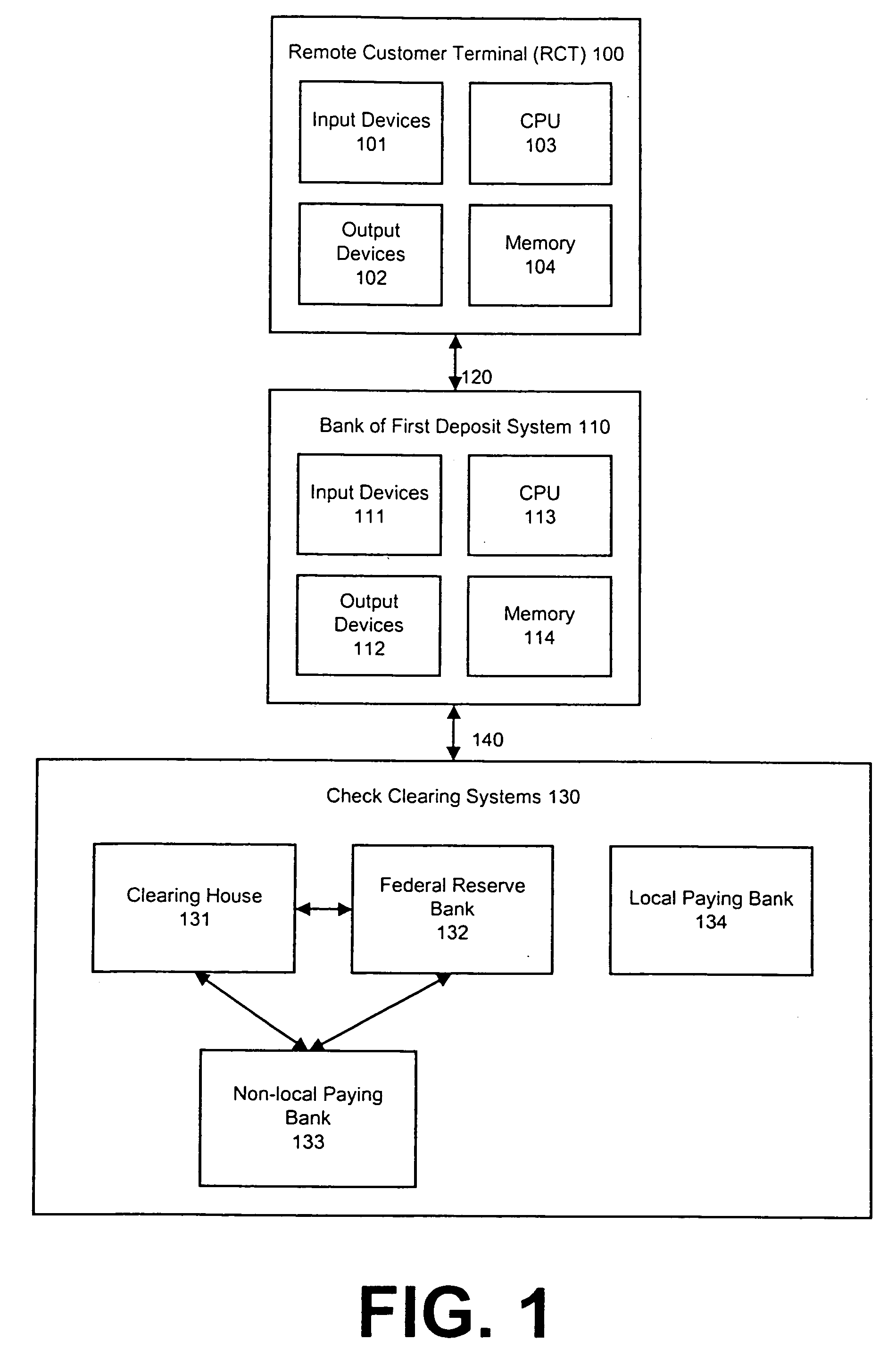

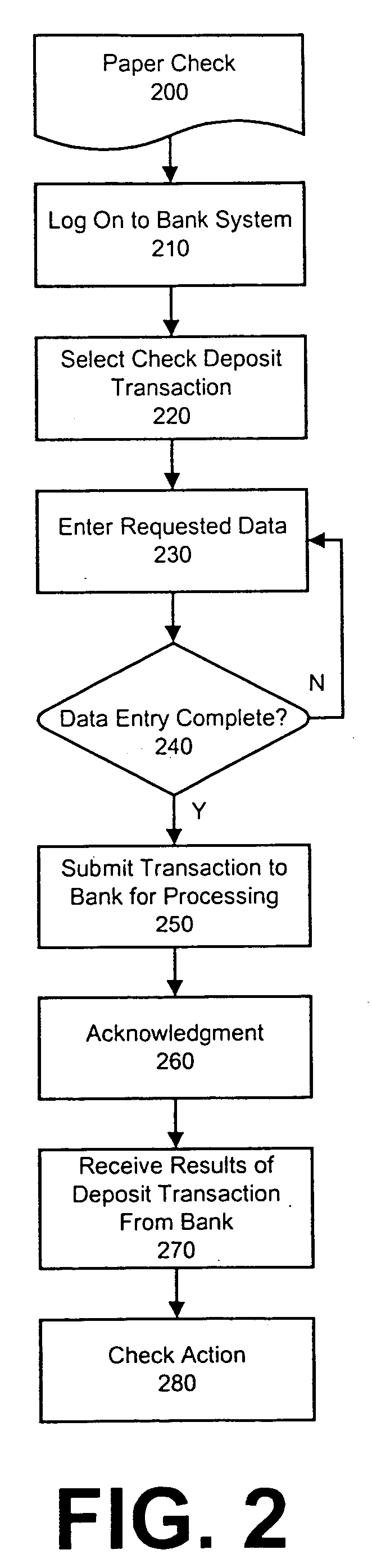

A system and method for initiating a deposit transaction, where the depositor is a non-commercial banking customer located at a remote location, and where the item to be deposited is a paper check from a third party, payable to the depositor. The enabling system features a Remote Customer Terminal (RCT) with certain input devices, connected to a bank system. The image and / or other data sent from the RCT to the Bank of First Deposit (BOFD) may be processed by conversion to Electronic Funds Transfer (EFT), via Electronic Check Presentment (ECP), or via check reconstruction. The new system and method provide convenience and improved transaction processing speed compared to other transactions that begin with a third party check.

Owner:BANK ONE CORPORATION

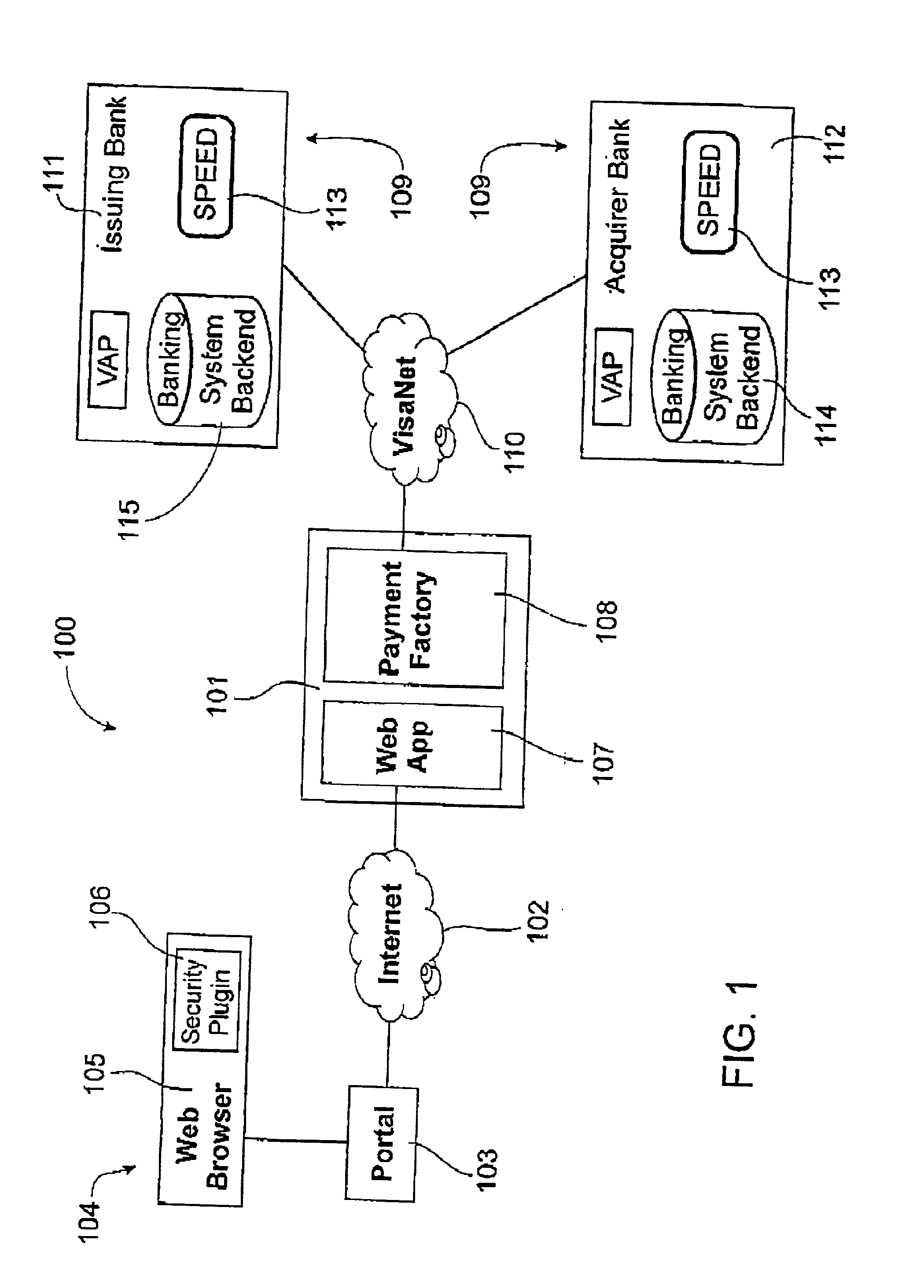

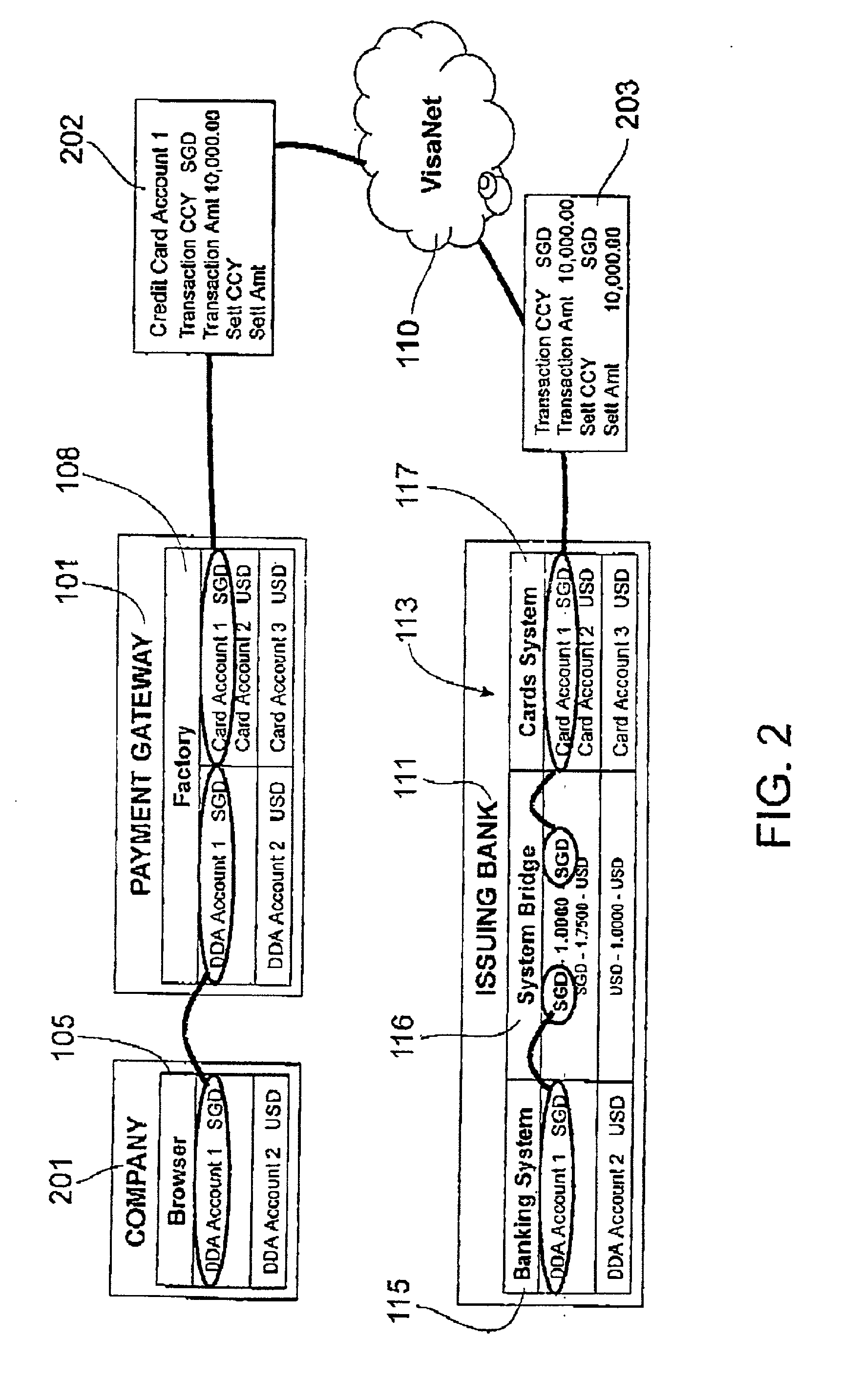

Electronic funds transfer system for processing multiple currency transactions

InactiveUS20020099656A1Implemented quickly and convenientlyReduce riskFinanceCurrency conversionCredit cardMachine learning

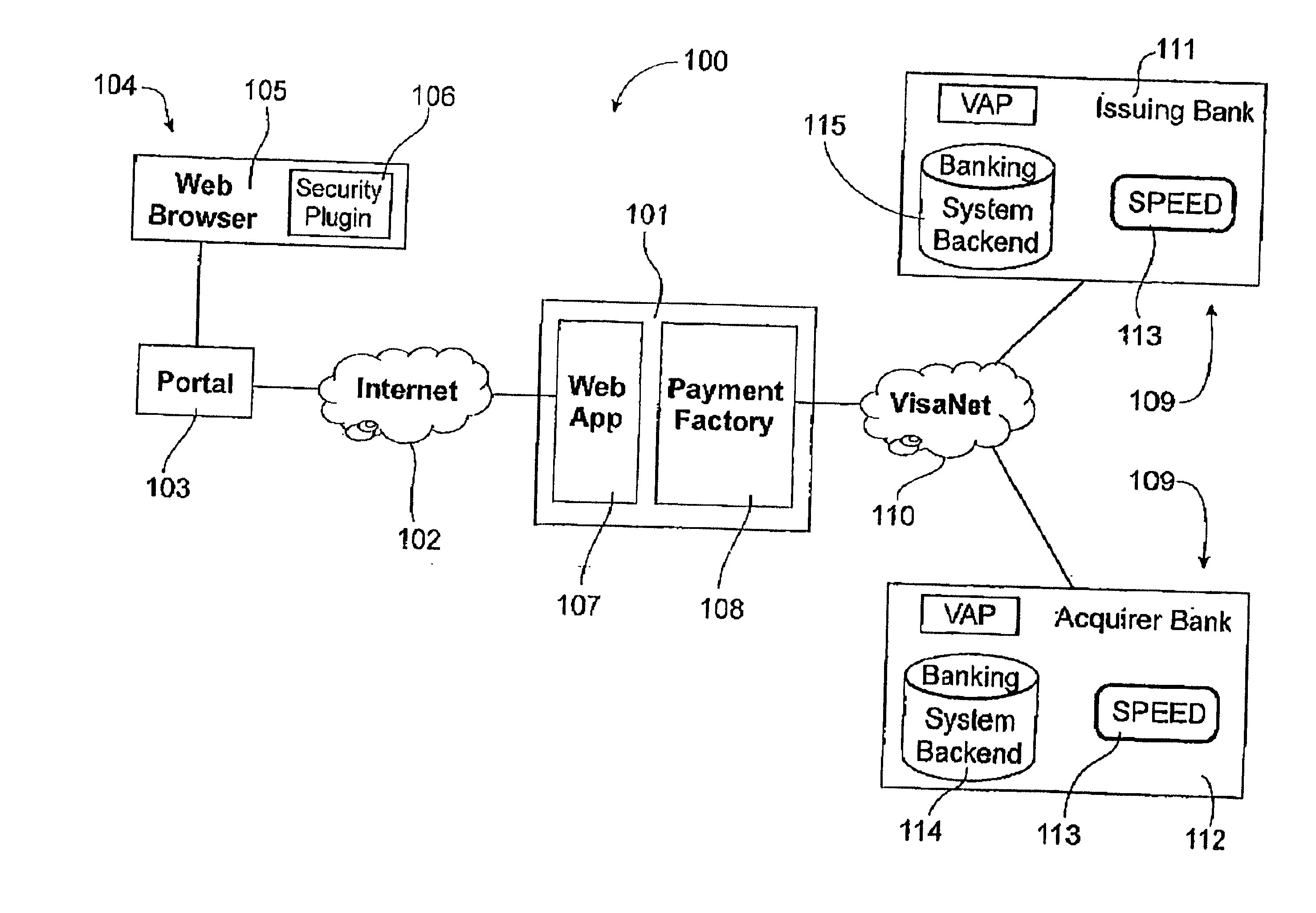

Methods of processing electronic transfers of funds from a payer account held at a payer financial institution to a financial settlement network in a currency that may be the same as or different from the funds in the payer account, and transfers from the financial settlement network to a payee account in a currency that, again, may be the same as or different from the funds in the payee account. The transfers are initiated by payment instructions transmitted by the payer to a payment gateway that provides mappings between the payer account and at least one credit card account in a currency nominated from those currencies supported by the payer financial institution for settlement purposes. The payment gateway also provides mappings between a plurality of payment currencies and at least one acquiring account held by a payee in a currency supported by an acquiring financial institution. Foreign exchange conversions involved in the transfers may be effected by the financial institutions, by the financial settlement network, or both as required. The methods optionally provide for transfers to financial institutions that are not members of the financial settlement network by providing agent financial institutions to integrate subsidiary national clearing networks.

Owner:VCHEQ COM PTE

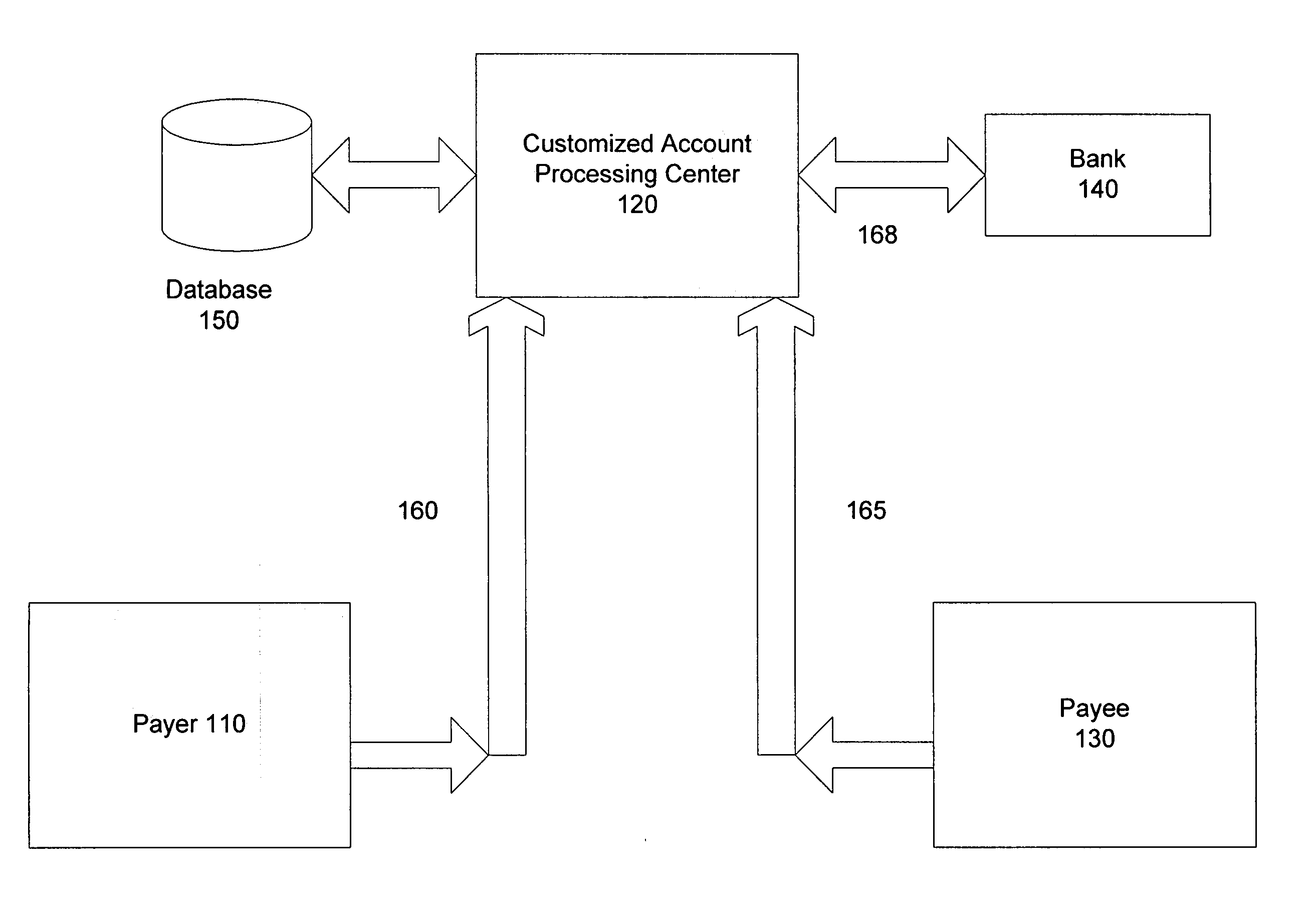

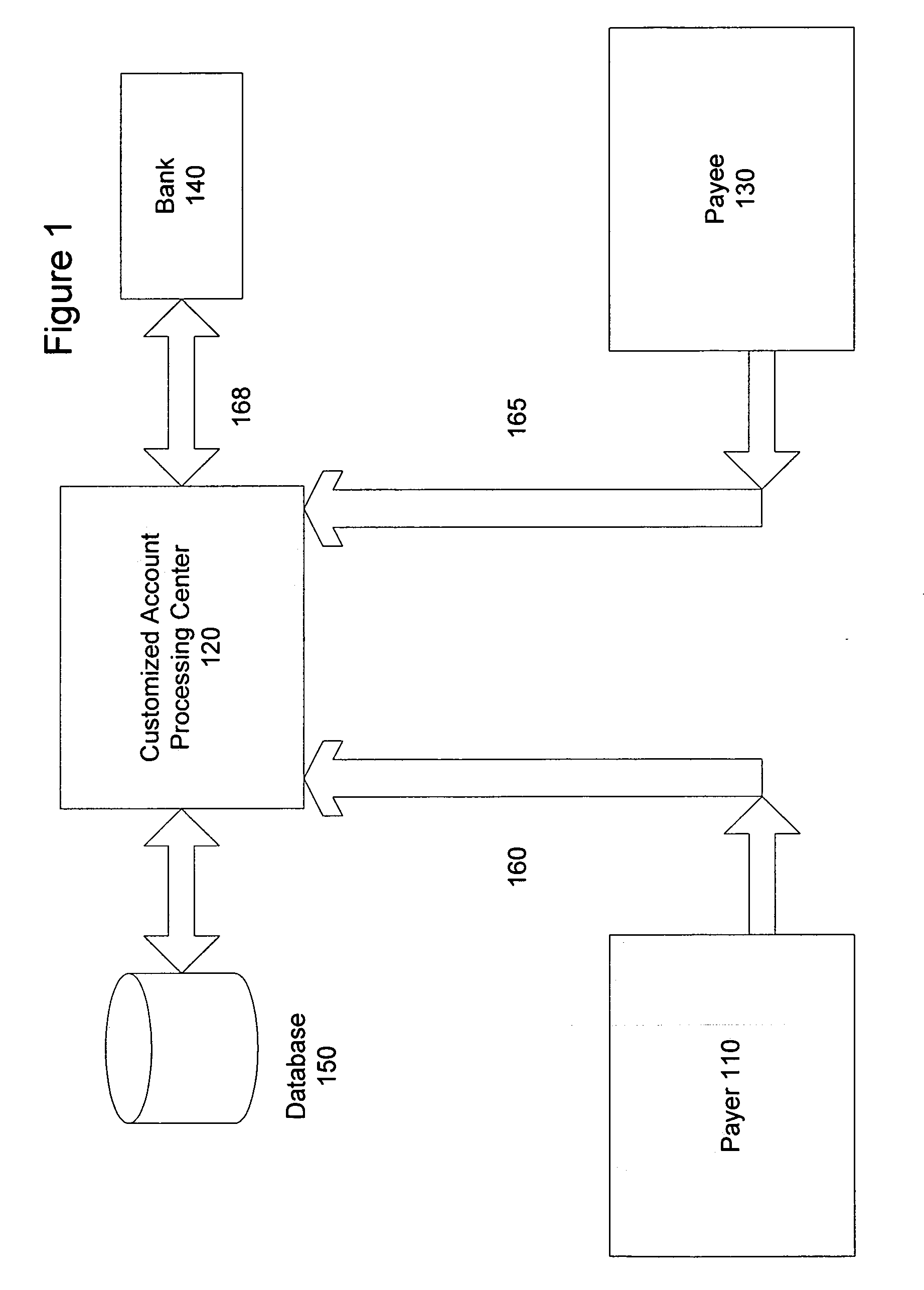

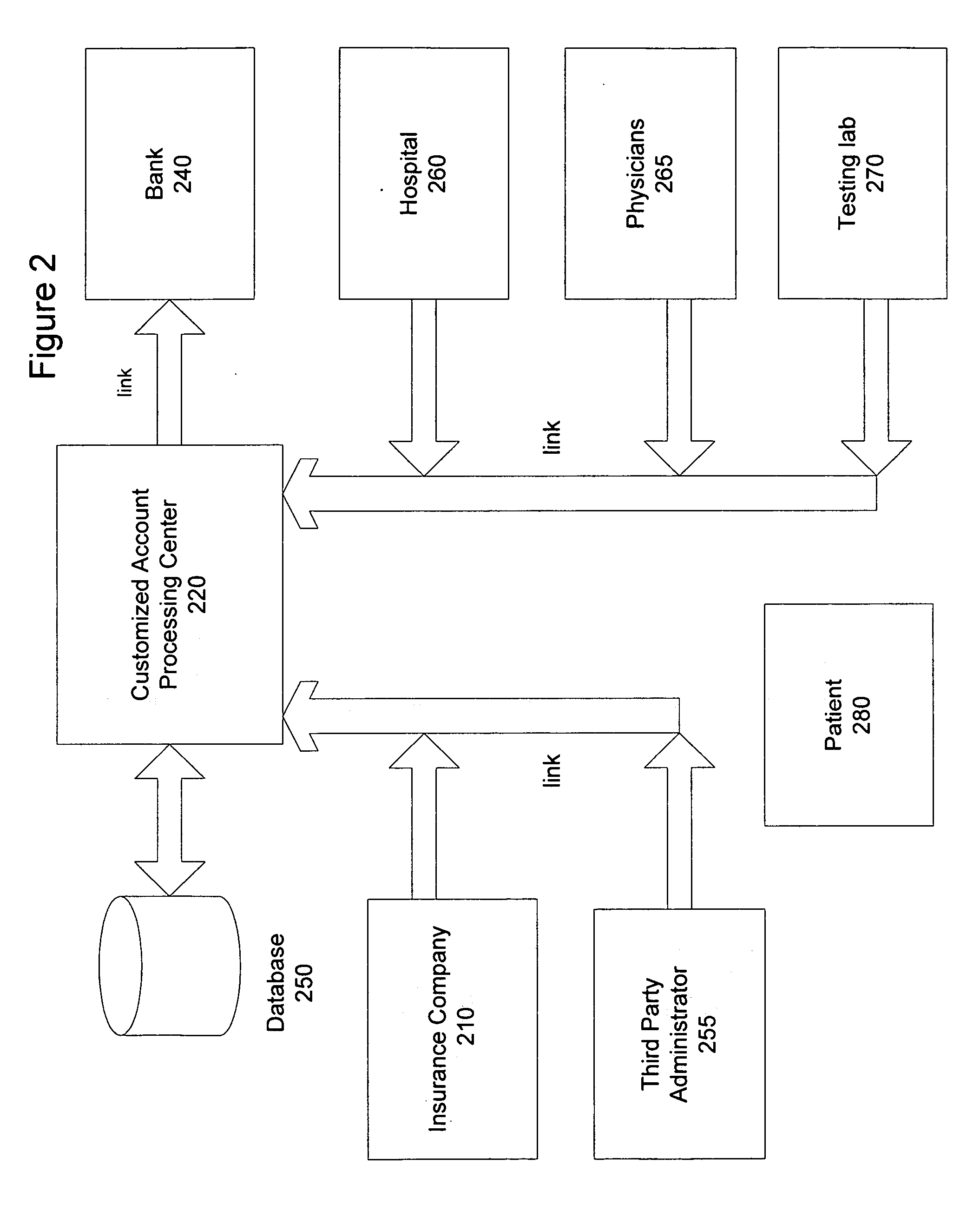

Customizable payment system and method

InactiveUS20060282381A1Avoid errorsPrevent fraudulent transactionFinanceBilling/invoicingBank accountComputer science

Owner:PAYFORMANCE CORP

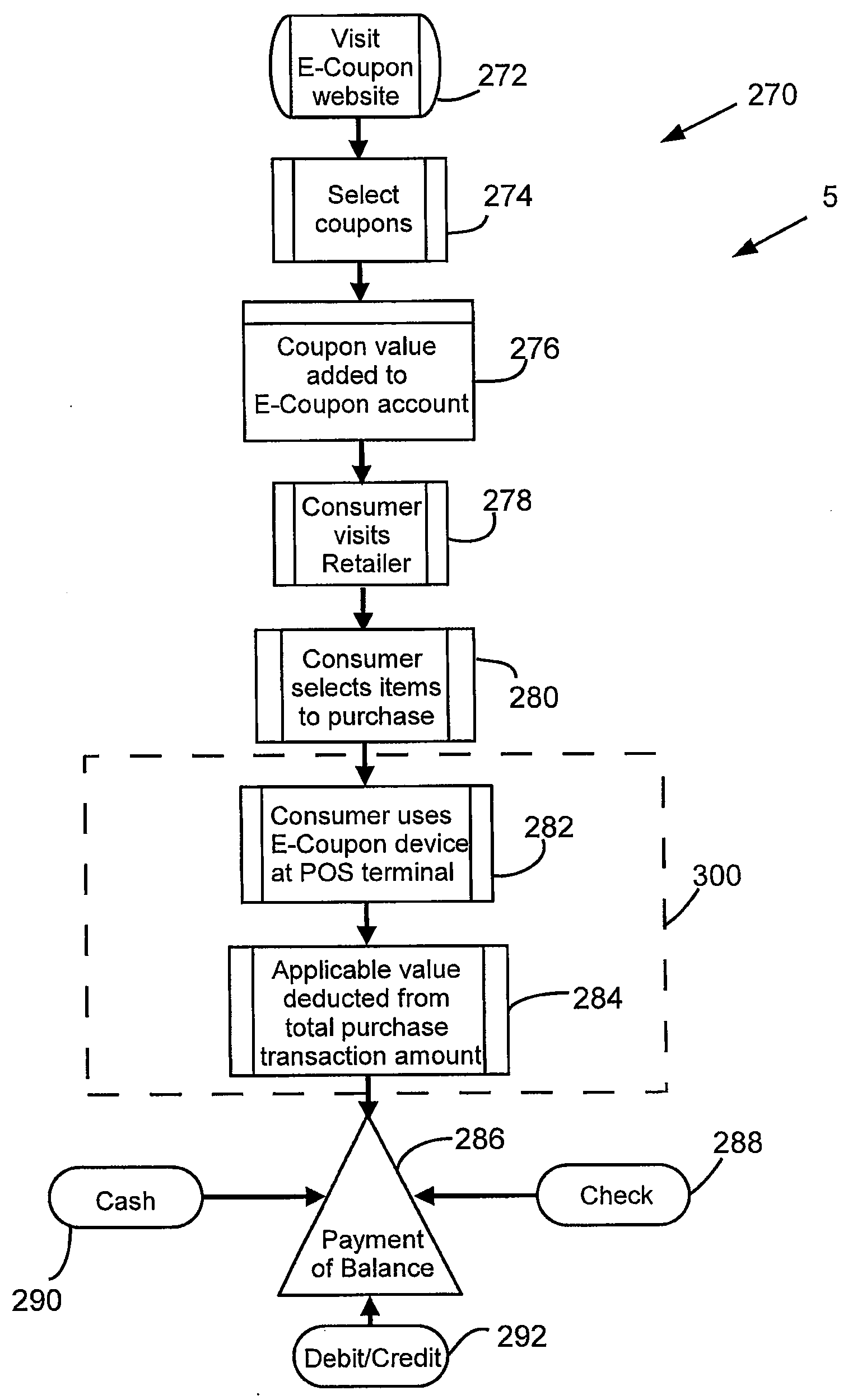

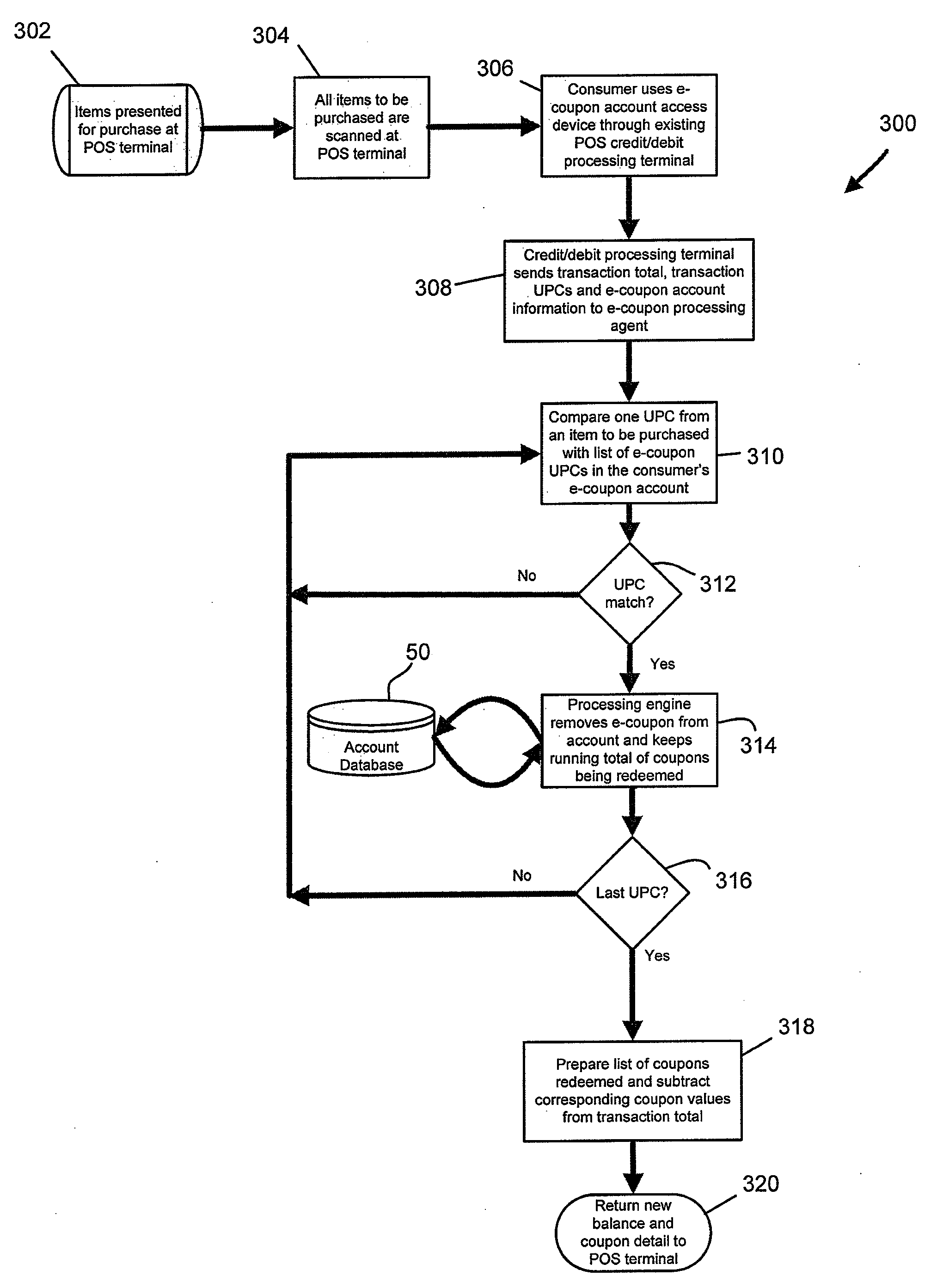

E-Coupon System and Method

InactiveUS20070288313A1Facilitating promotional communicationFacilitate communicationPoint-of-sale network systemsMarketingEFTSDebit card

A method wherein a consumer registers for an electronic coupon (e-coupon) program and receives an e-coupon card programmed with consumer and corresponding e-coupon account identification information. The consumer selects available coupons from a website which are then loaded into the e-coupon account. Consumer package goods manufacturers (CPGs) are charged the downloaded value of the coupon plus a fee. The consumer may use the e-coupon card at any retailer that has electronic funds transfer (EFT) capabilities, such as credit / debit card acceptance. At a retailer's point of sale (POS) terminal, the consumer swipes the card and the cost of items having an e-coupon is adjusted by the corresponding e-coupon value and deducted from the consumer's final amount due. The CPG is also charged a redemption fee and the retailer is charged an interchange fee. Expired coupons are automatically removed from the account and their value refunded to the CPGs. Reports on redeemed coupons and redeemer profiles can be generated and provided to the CPGs or retailers.

Owner:FIDELITY INFORMATION SERVICES LLC

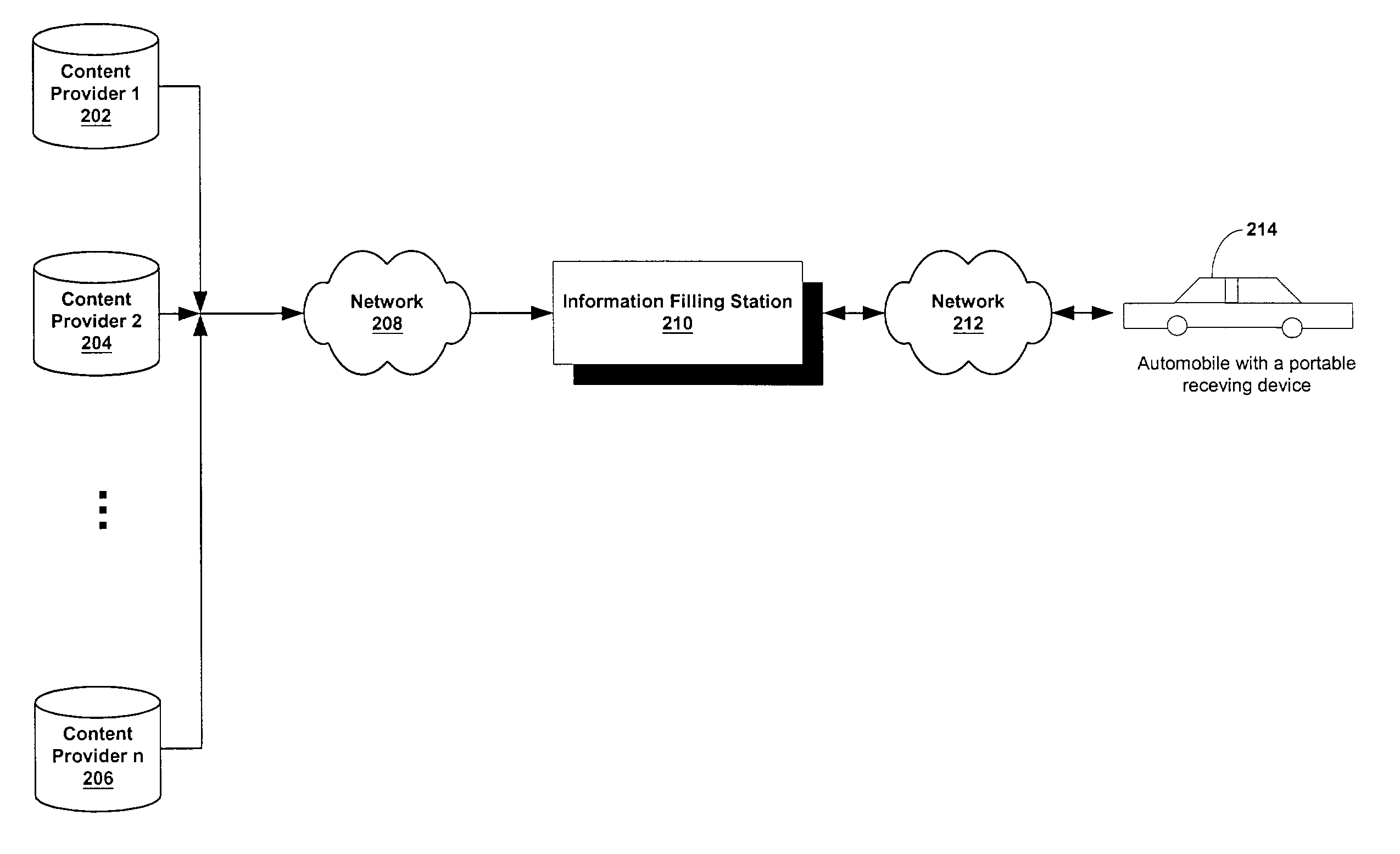

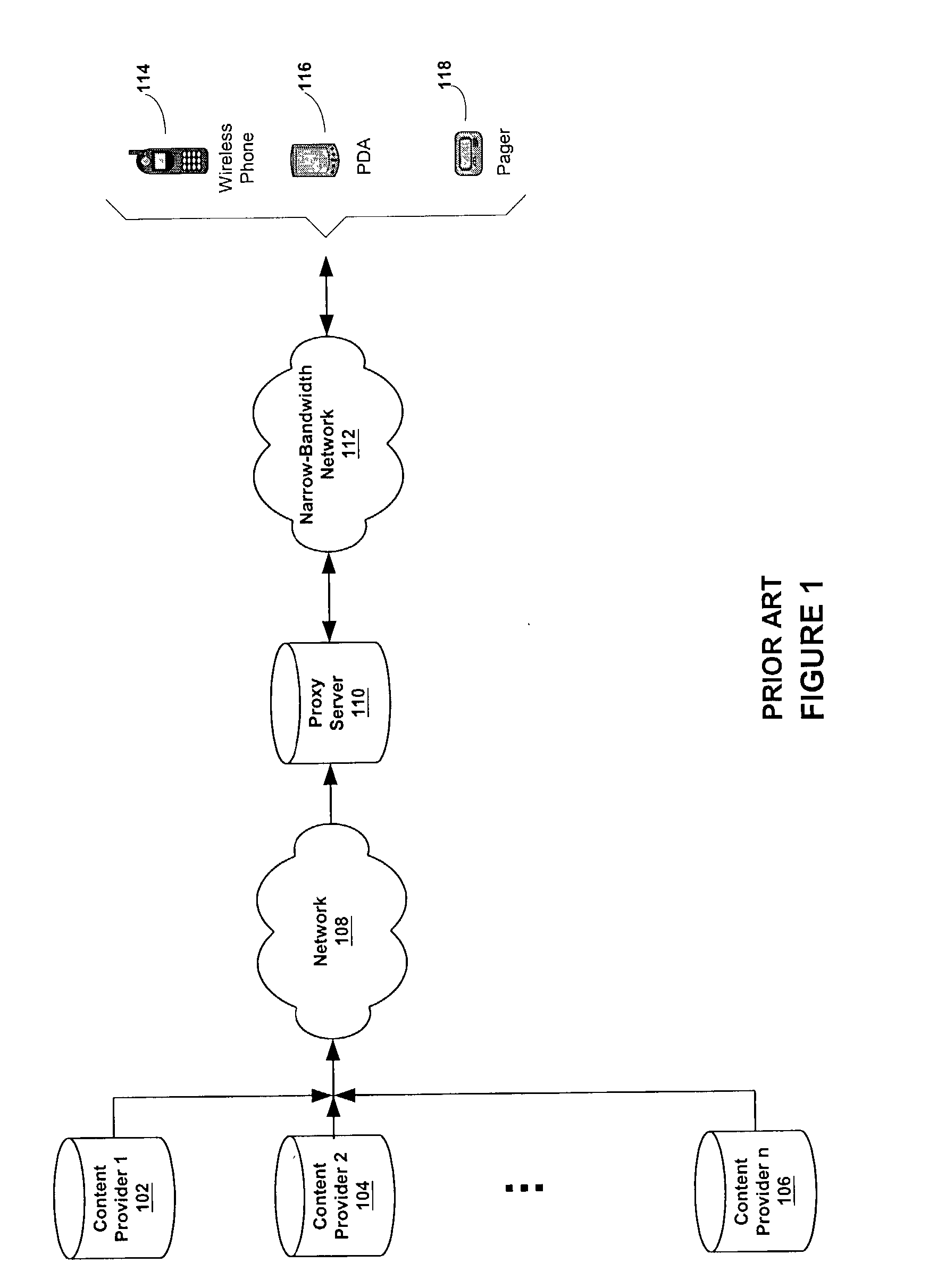

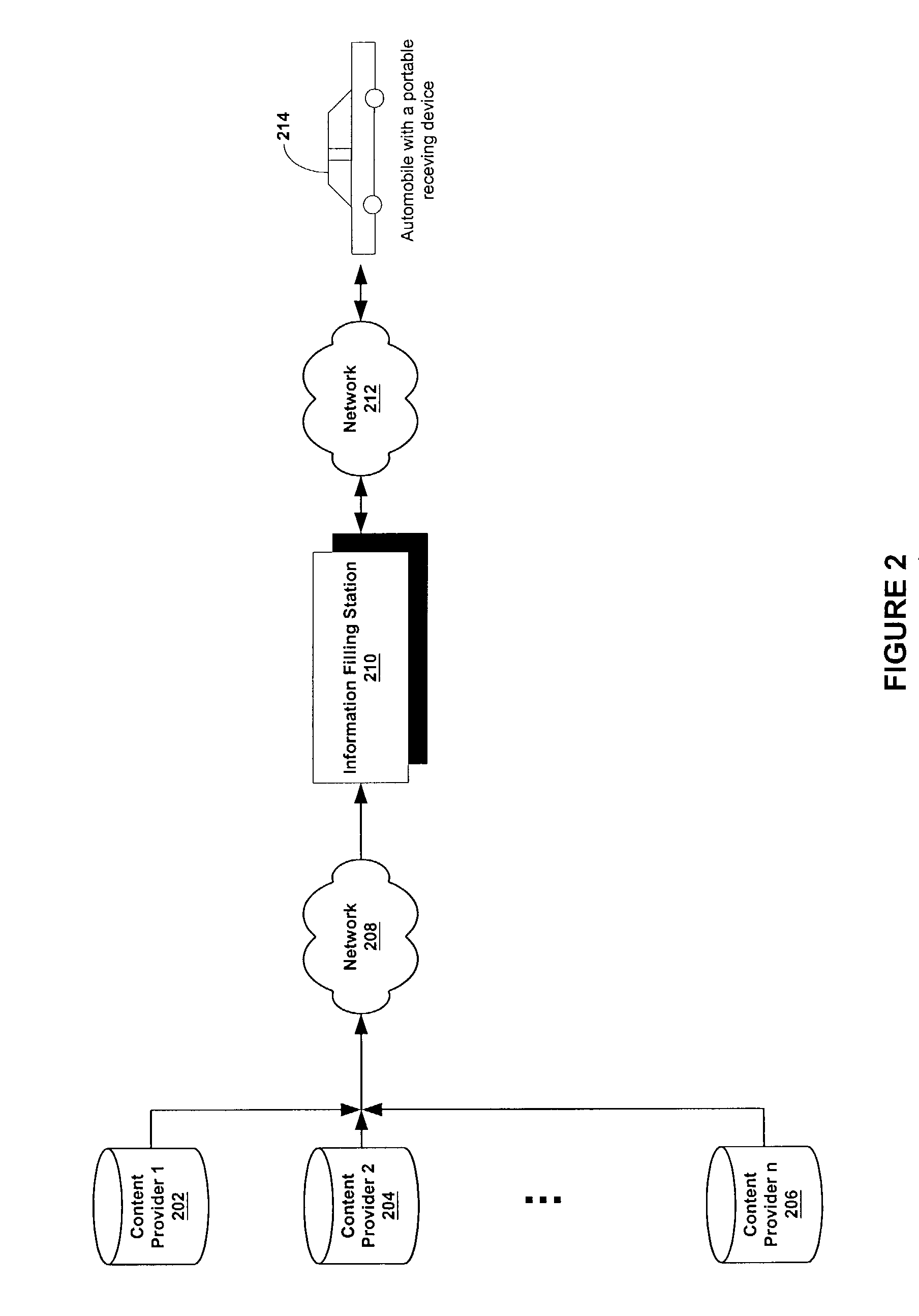

Information filling station facilitating wireless transfer of data content to a portable device or other pre-defined locations

InactiveUS20040002359A1Television system detailsBroadcast transmission systemsComputer networkData file

Data content providers transfer data content (including DRM protected content) over a broadband network onto one or more information filling stations (IFSs) situated at one or more physical locations. Users are able to wirelessly communicate with the IFSs via one or more of portable devices that are operable in close proximity to the IFS. Data content requested by the portable devices include, but are not limited to: multimedia files, WWW data, real-time and interactive games, e-mail (with or without attachments), electronic newspapers, news and sports information, traffic and weather information, e-books, interactive messaging, and / or data files. Additionally, the portable devices are also capable of facilitating point-of-sale purchases and electronic funds transfers. Optionally, the IFS also forwards advertisements promoting products and services to the portable devices. The portable device is also able to instruct the IFS to selectively send each content of interest or product of interest to one or more identified locations (e.g., users can send large multimedia to their home PCs).

Owner:AT&T INTPROP I L P

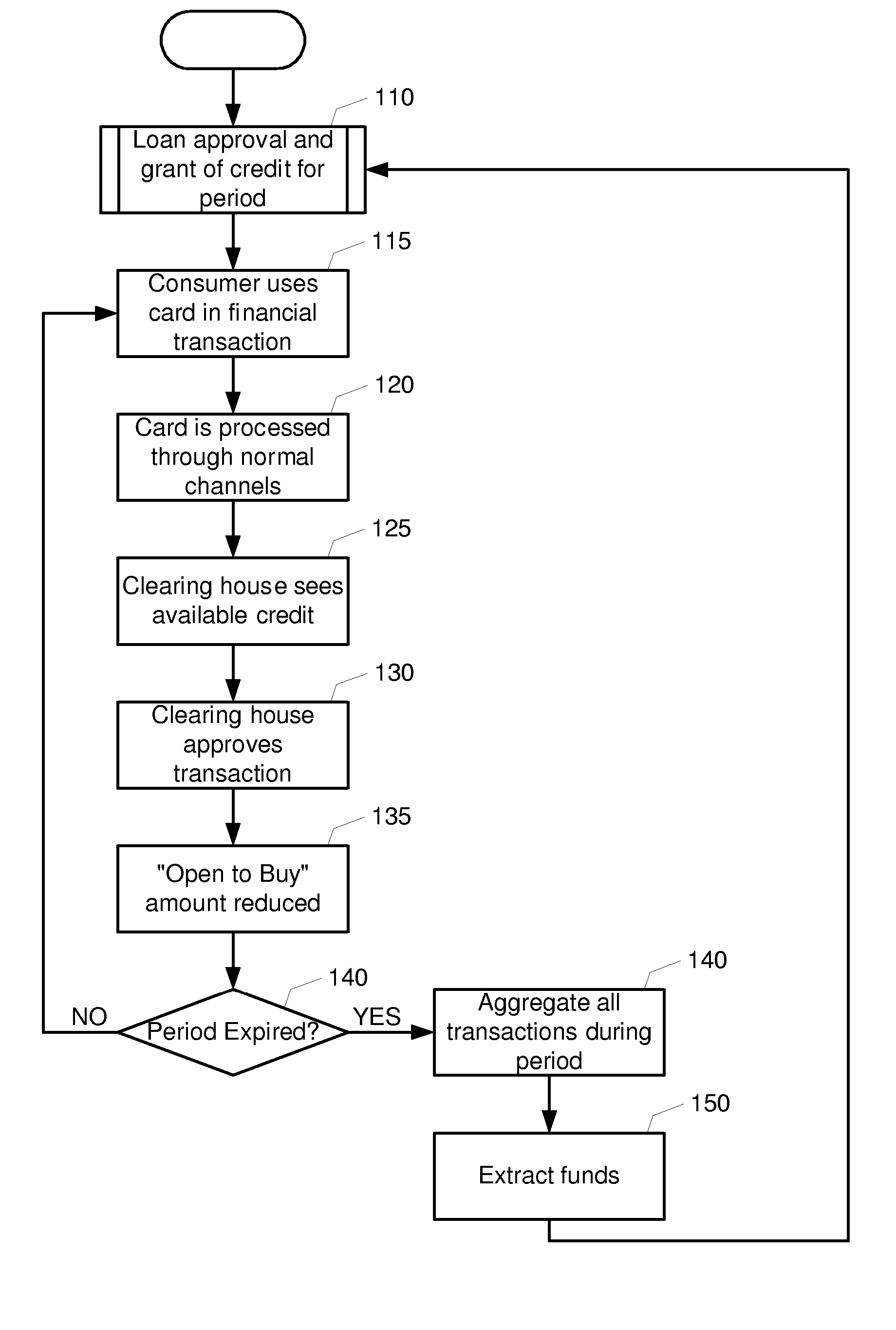

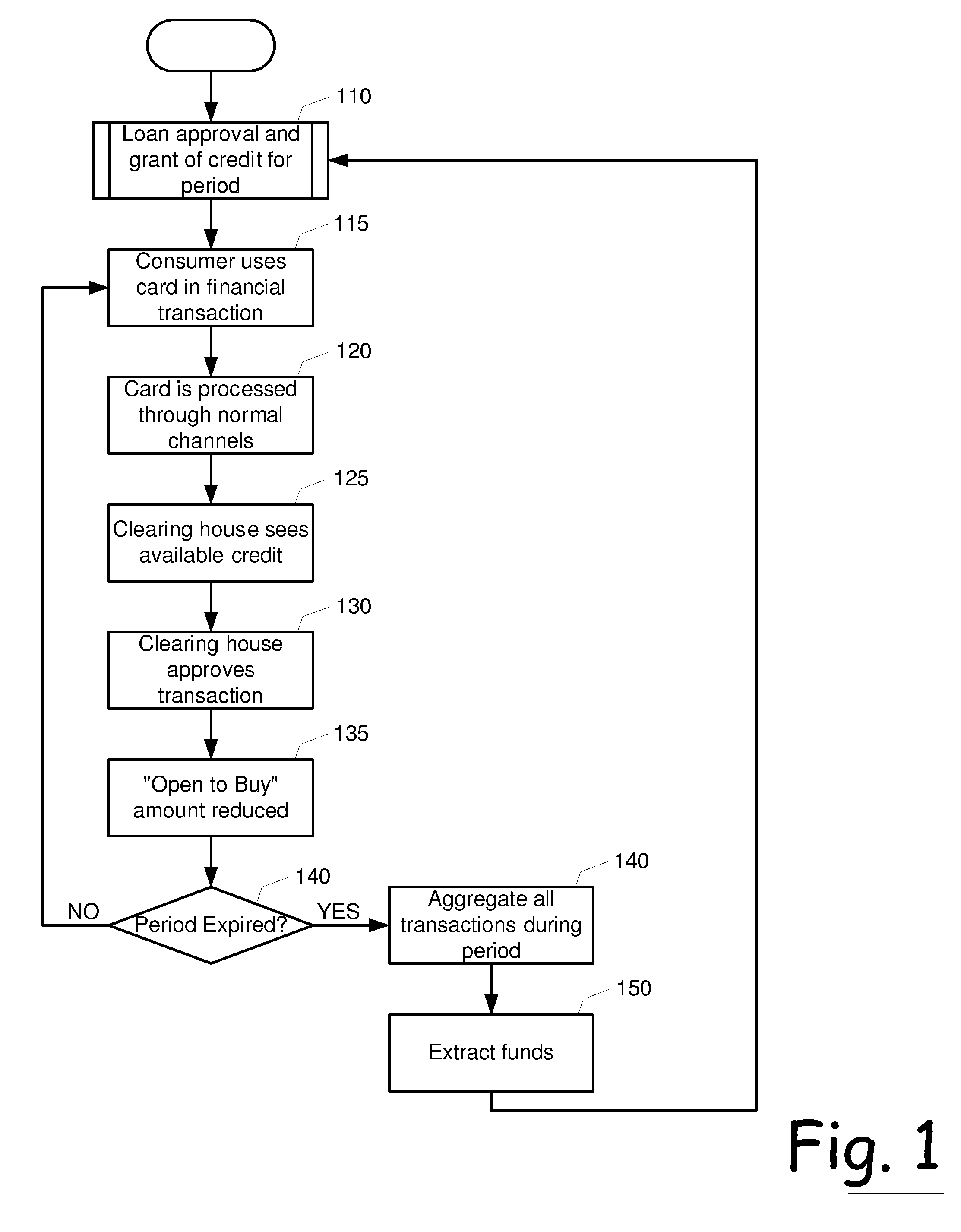

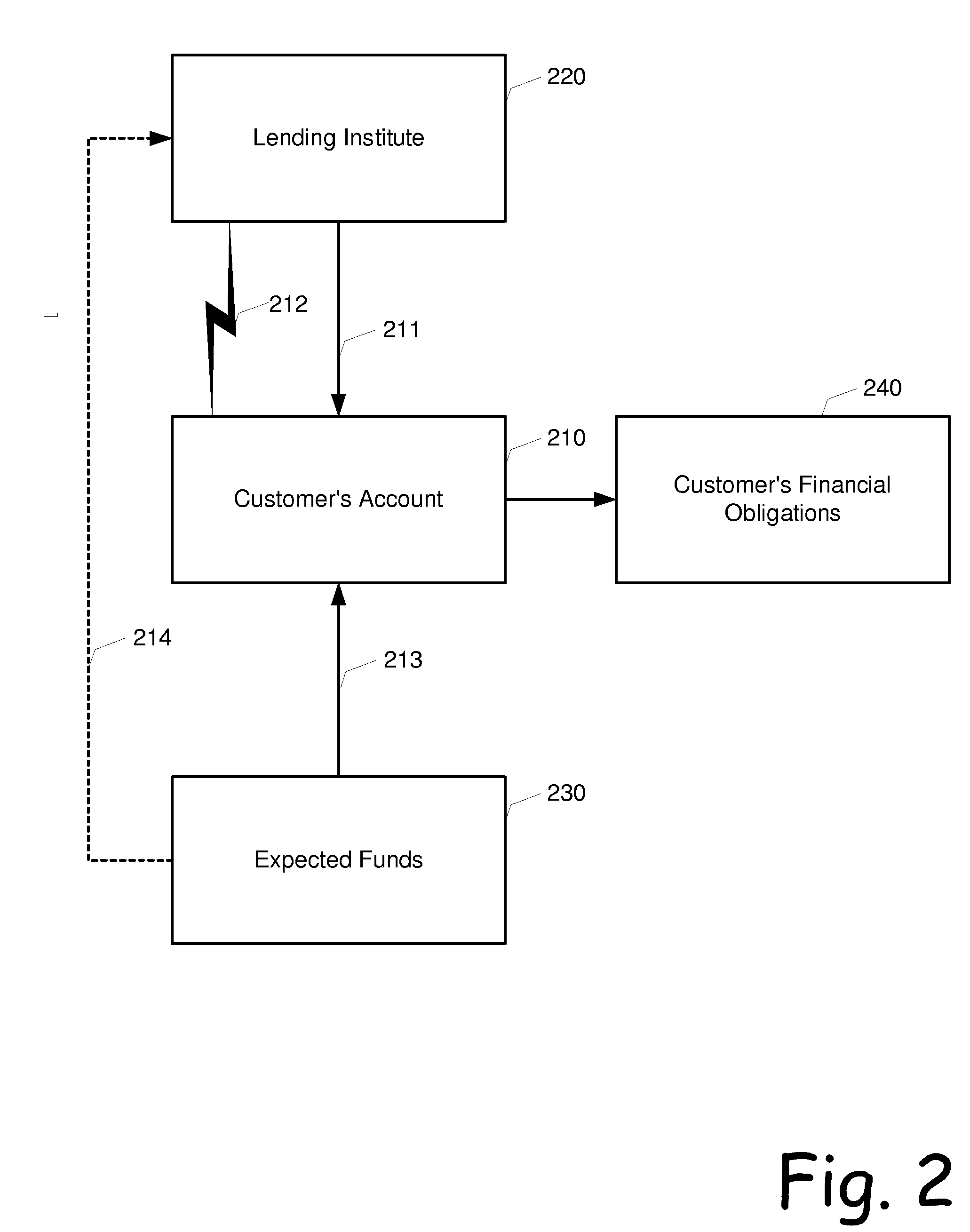

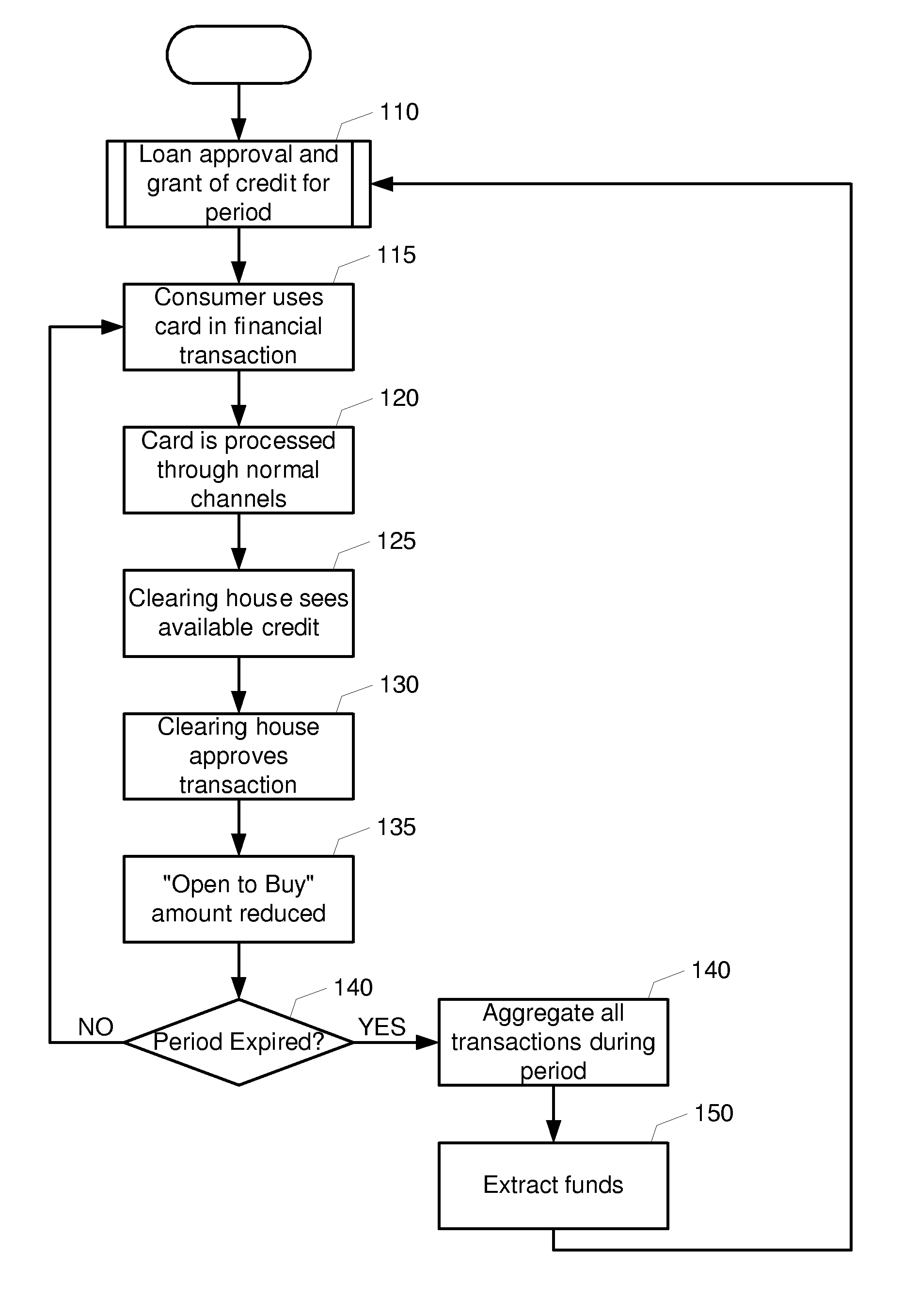

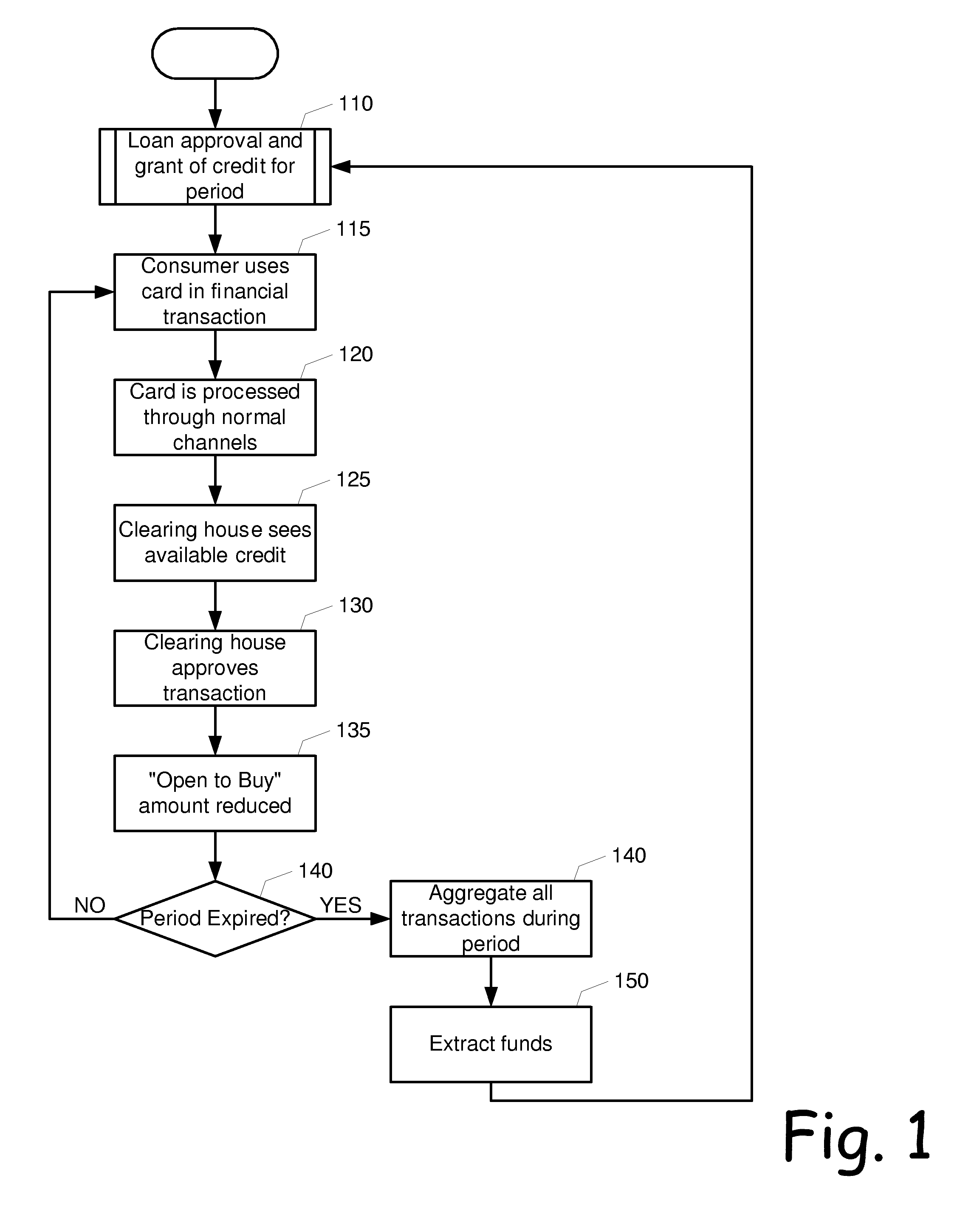

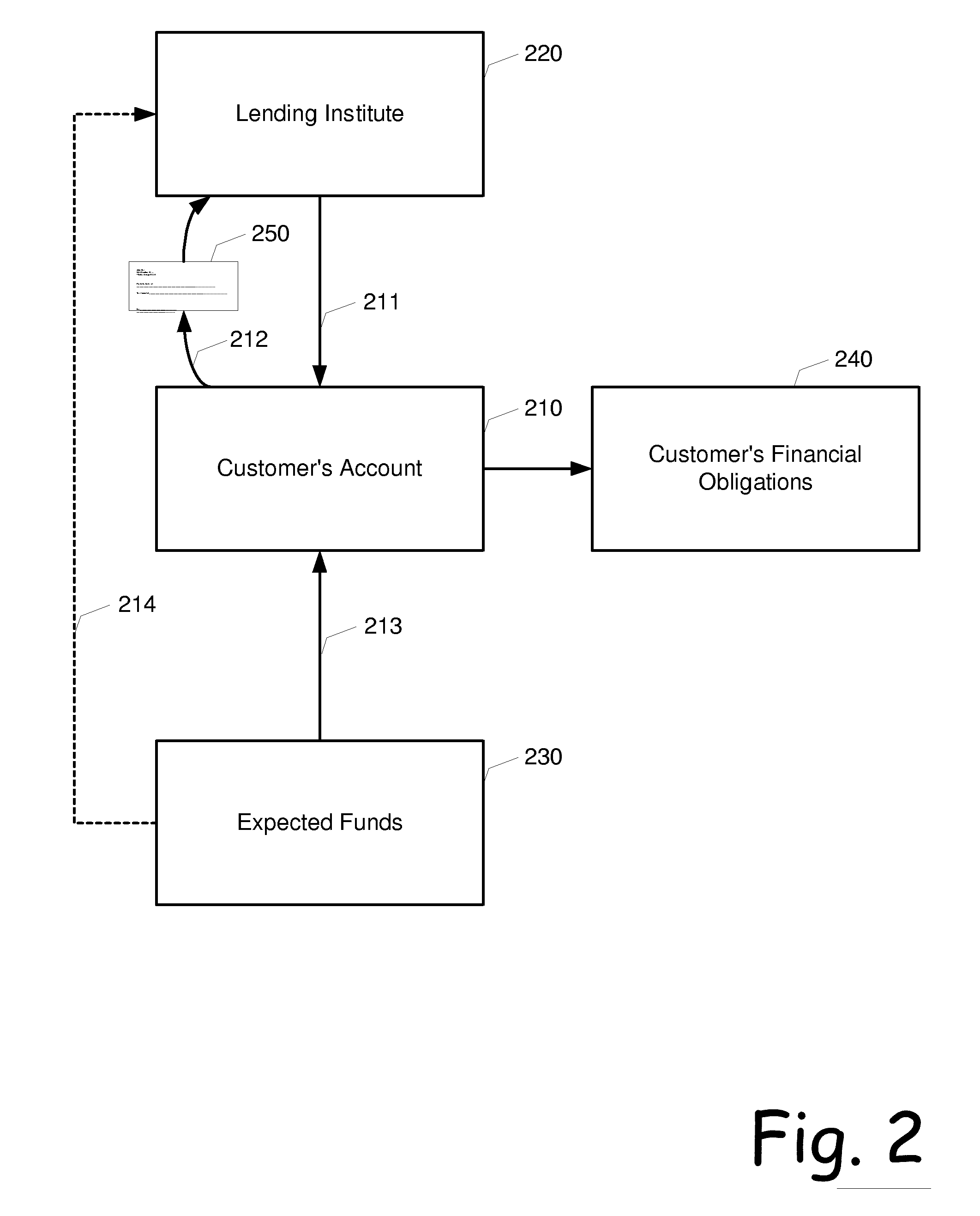

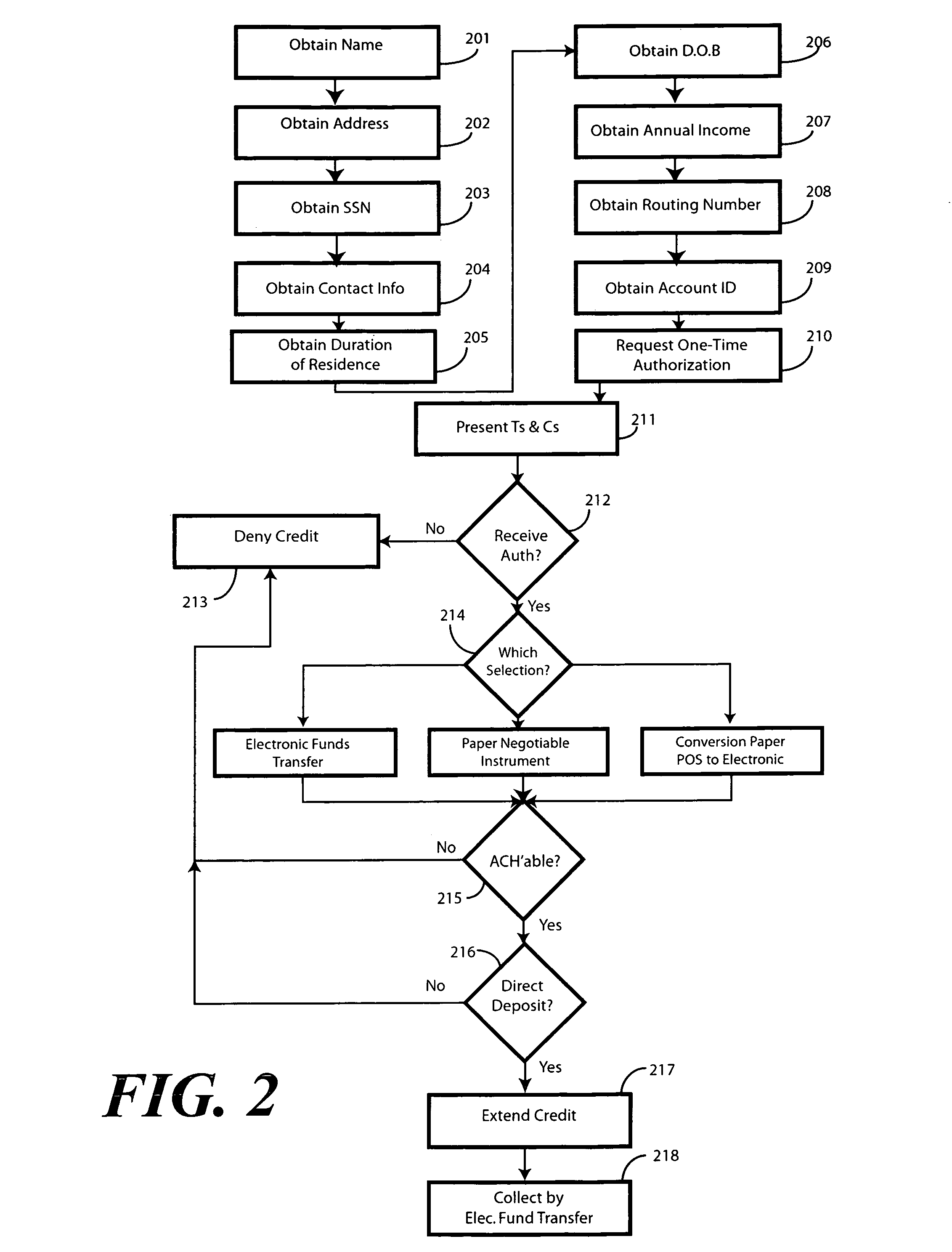

Credit underwriting based electronic fund transfer

A credit underwriting technique that allows a consumer to gain early access to funds for paying bills or conducting financial transactions contingent upon the consumer having a high-degree of reliability on the reception of future funds, and / or the granting of access to at least a portion of the funds represented by the future funds when received. The access can be in the form of an electronic transfer from an account in which the funds are deposited, or a direct deposit of the funds into either a lender accessible account or into the lenders account directly. The access can be applied for aggregated financial transactions or can be periodically applied for recurring transactions.

Owner:COMPUCREDIT INTPROP HLDG CORP II

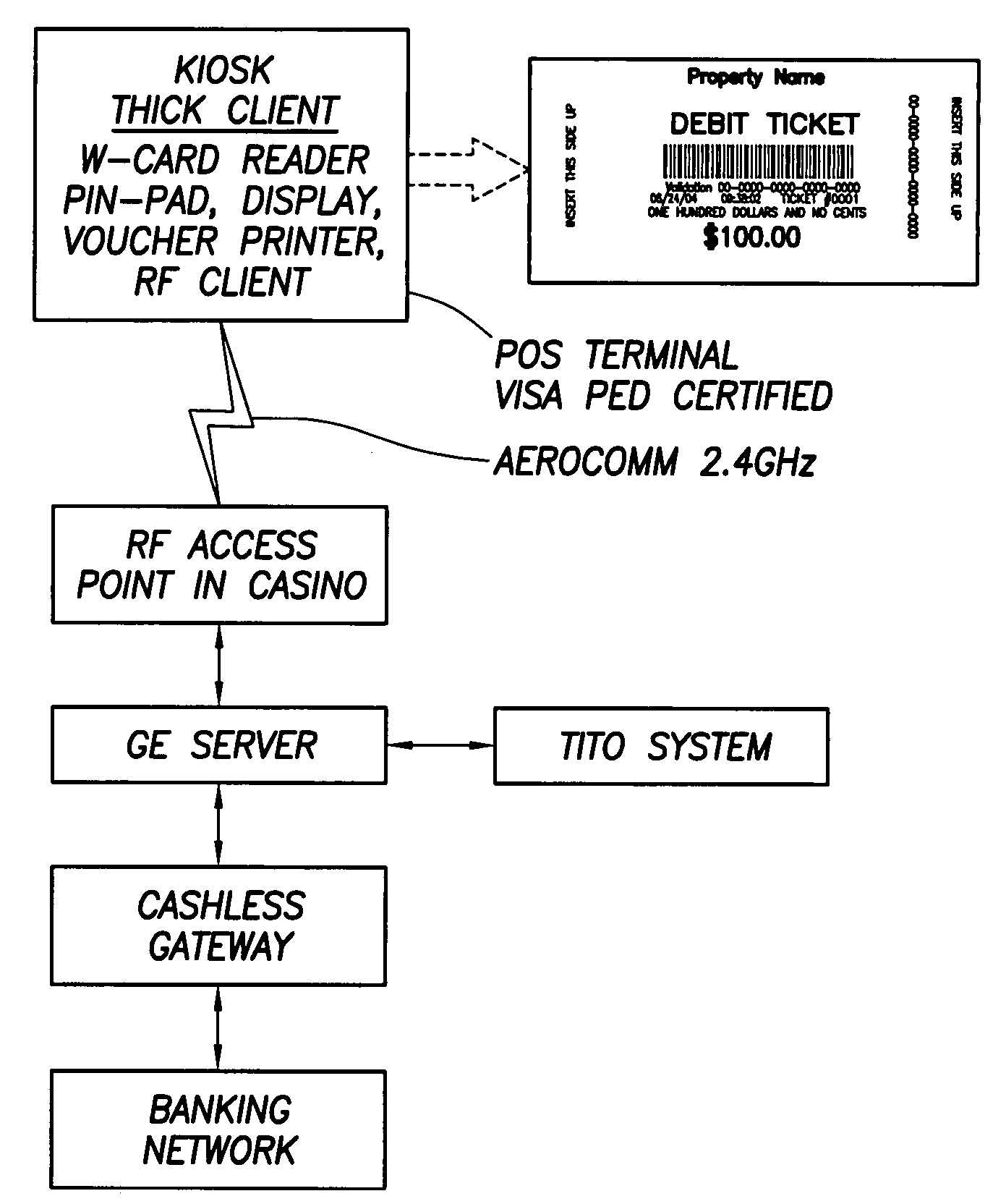

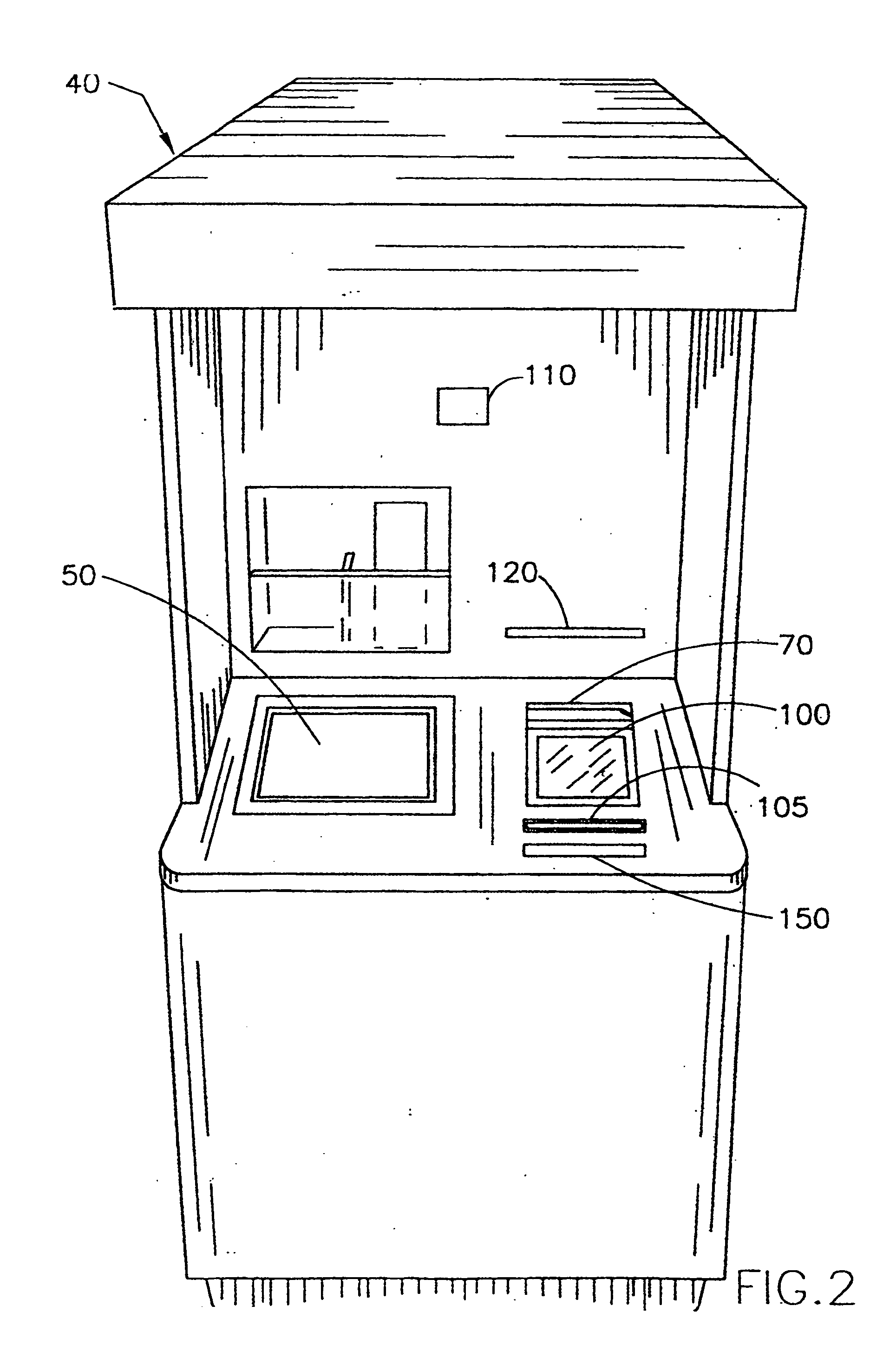

Purchase of slot vouchers with electronic funds (improved method and apparatus)

InactiveUS20060068897A1Increase guest safetyLoss and theftPayment architectureApparatus for meter-controlled dispensingElectronic funds transferGame machine

Apparatus and method for the purchase of gaming vouchers (slot vouchers) with commercial bank cards using electronic funds transfer including a kiosk located on a gaming floor proximate to gaming machines but separate from a particular gaming machine, an EFT reader and processing system, user interactive communication equipment, voucher issuing equipment and means for communicating with both a commercial EFT system and a voucher accounting system, and including personal daily limit options.

Owner:GLOBAL CASH ACCESS

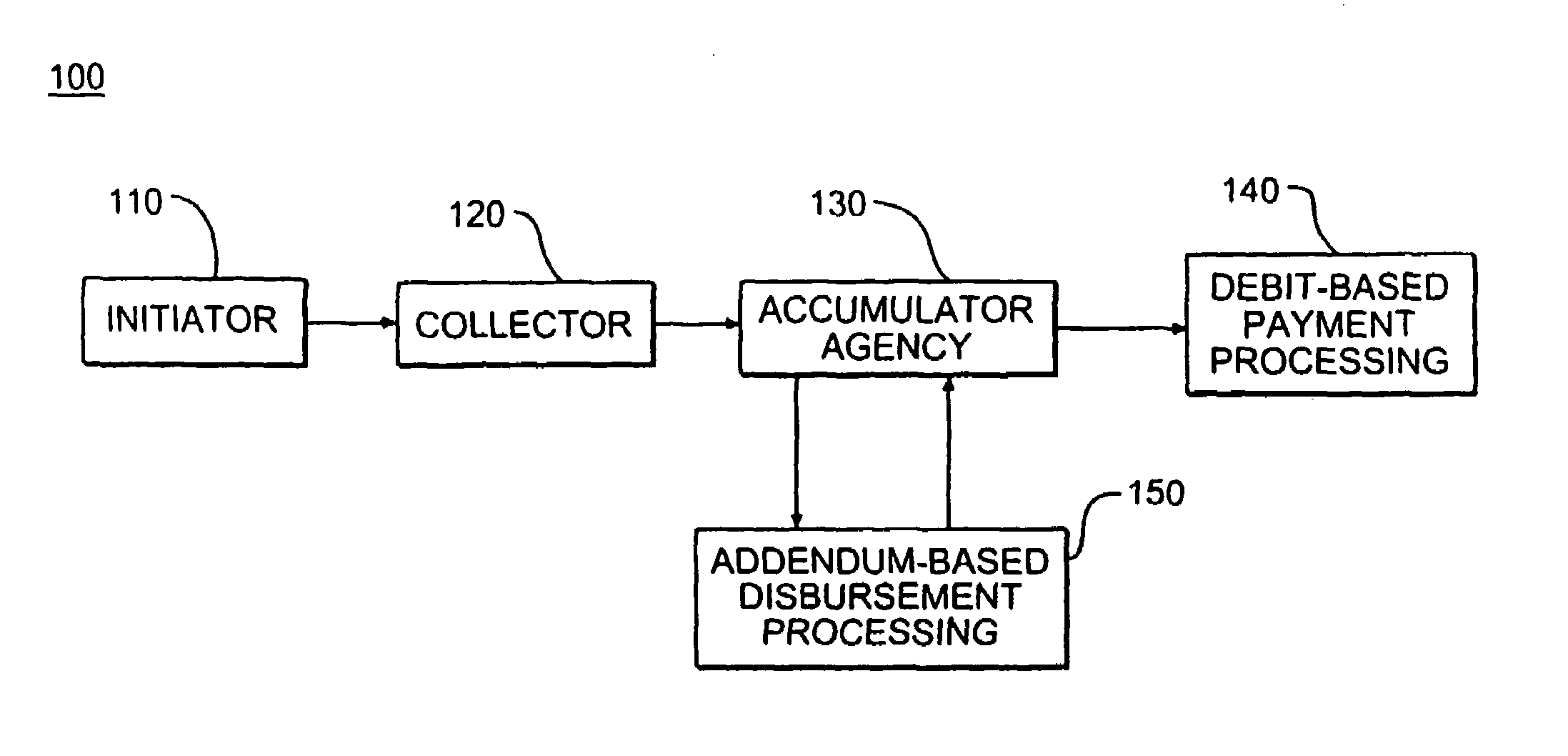

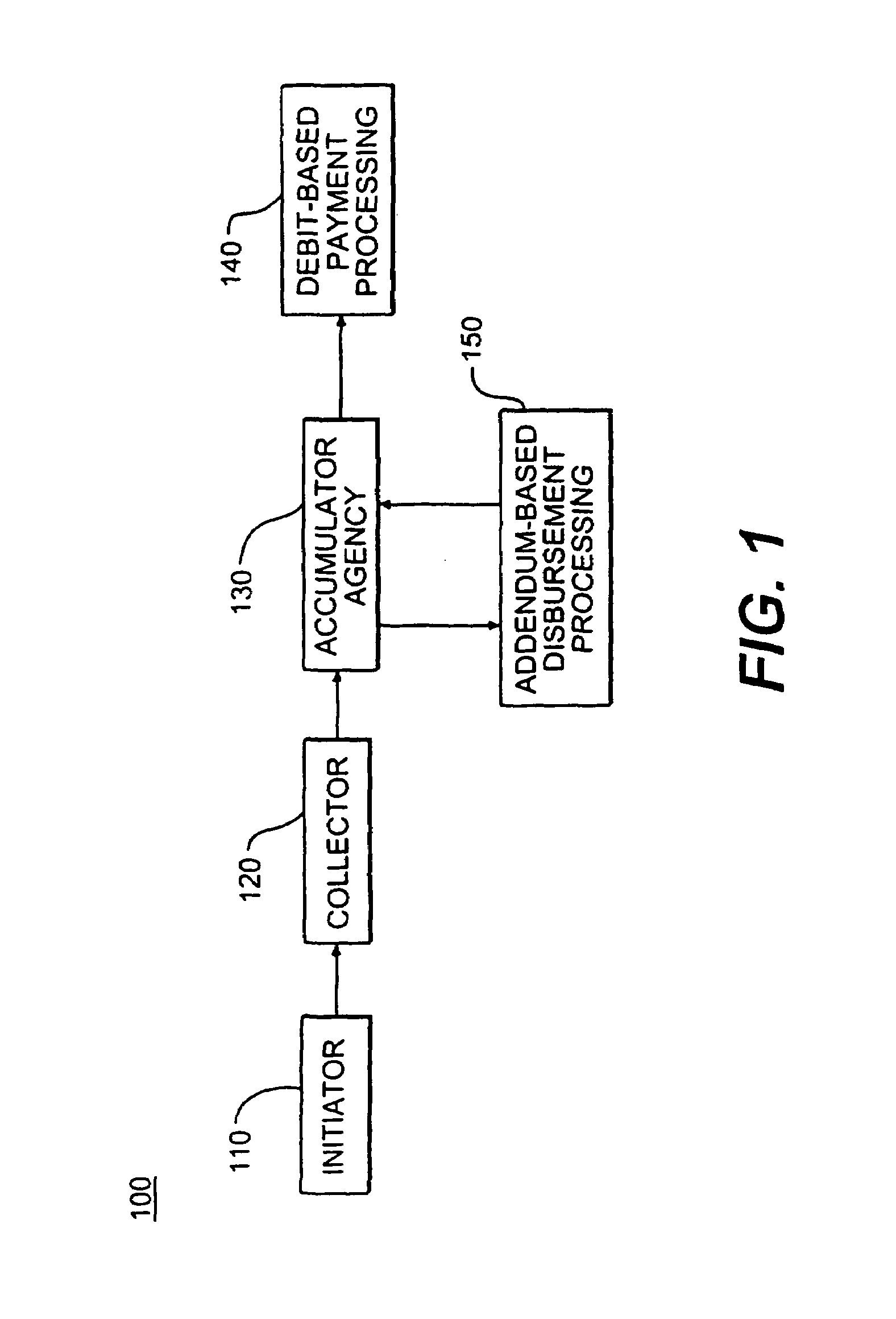

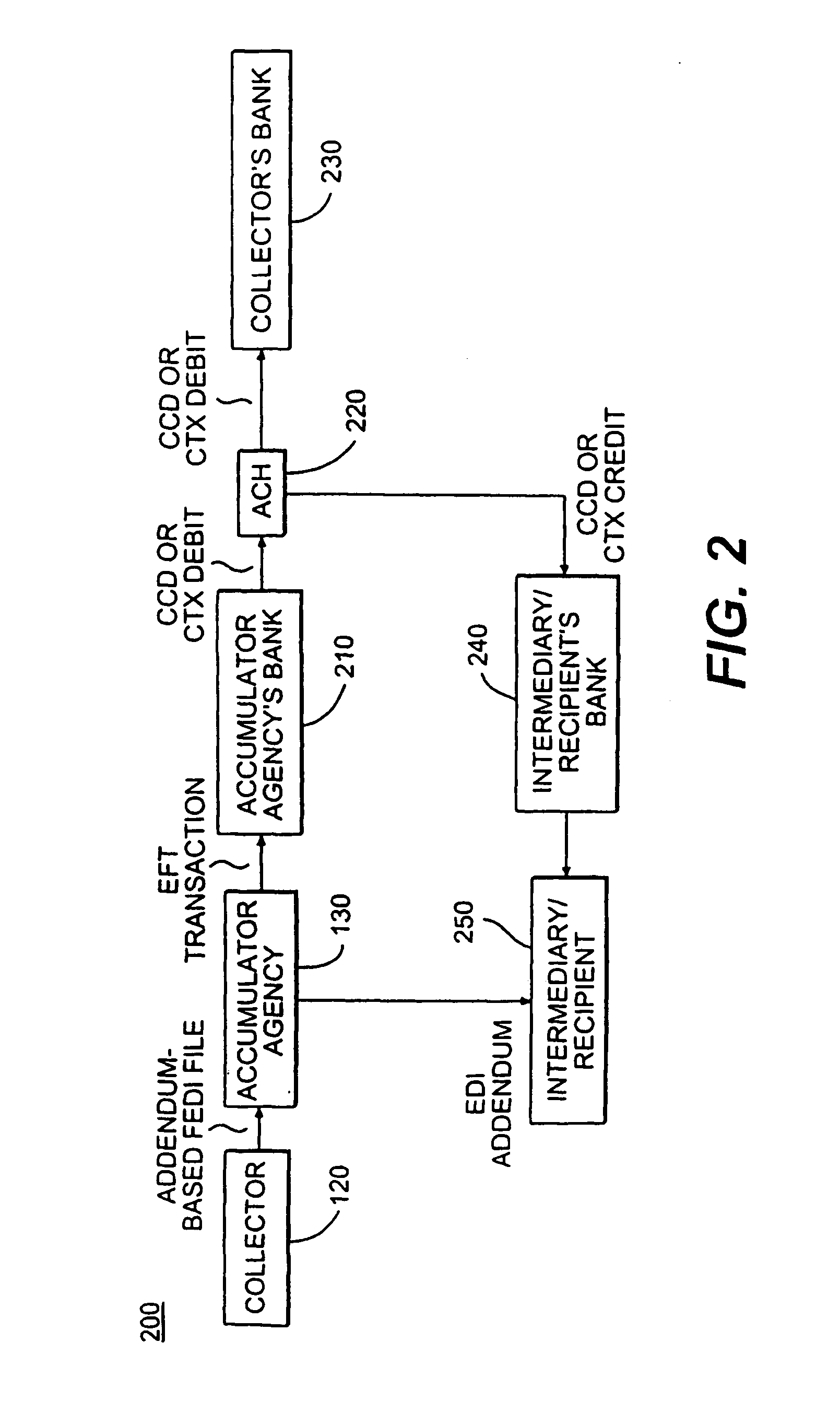

Method and apparatus for payment processing using debit-based electronic funds transfer and disbursement processing using addendum-based electronic data interchange

InactiveUS7225155B1Easy to processFinanceDigital data processing detailsEFTSElectronic funds transfer

This disclosure describes a payment and disbursement system, wherein an initiator authorizes a payment and disbursement to a collector and the collector processes the payment and disbursement through an accumulator agency. The accumulator agency processes the payment as a debit-based transaction and processes the disbursement as an addendum-based transaction. The processing of a debit-based transaction generally occurs by electronic funds transfer (EFT) or by financial electronic data interchange (FEDI). The processing of an addendum-based transaction generally occurs by electronic data interchange (EDI).

Owner:ACS STATE & LOCAL SOLUTIONS

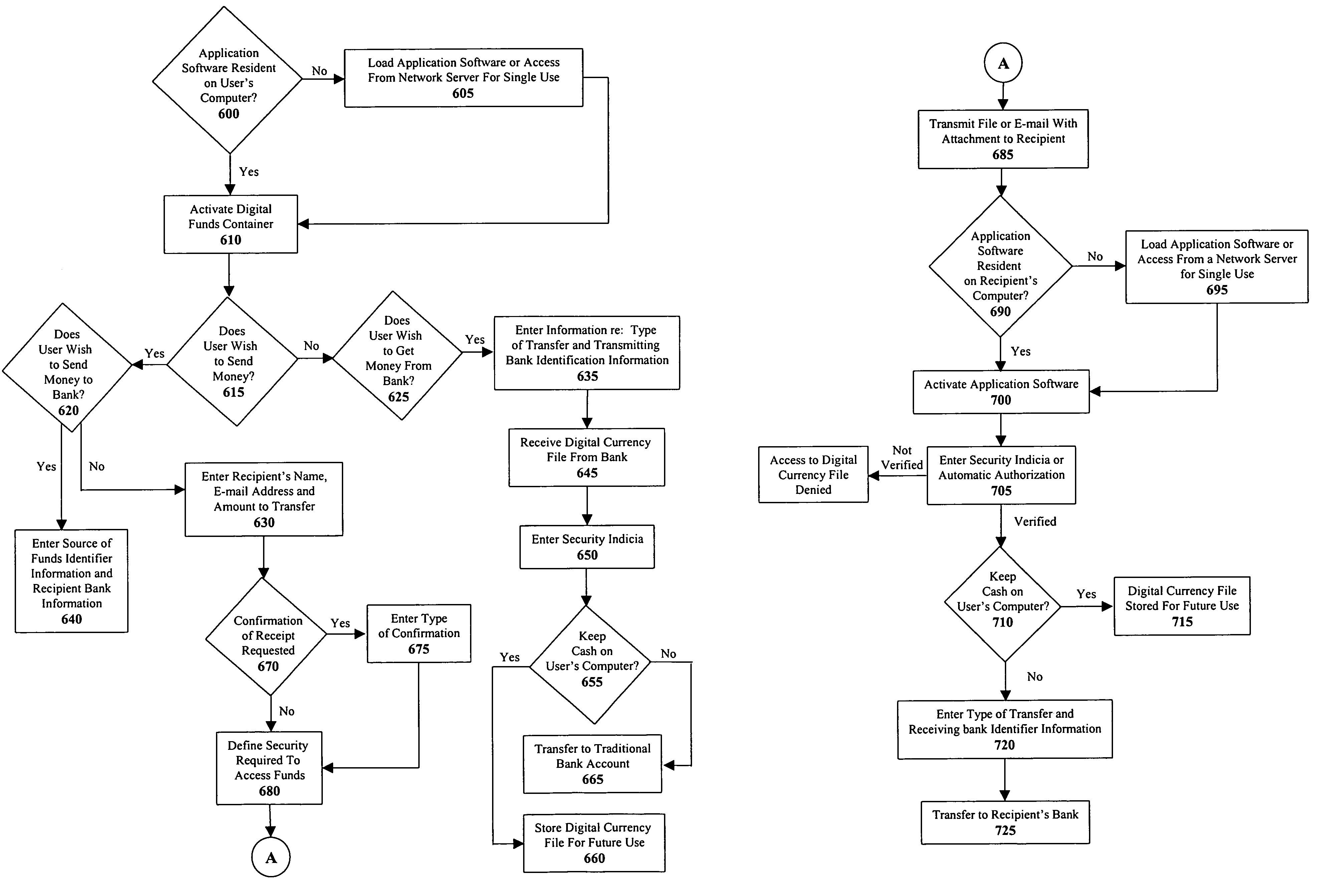

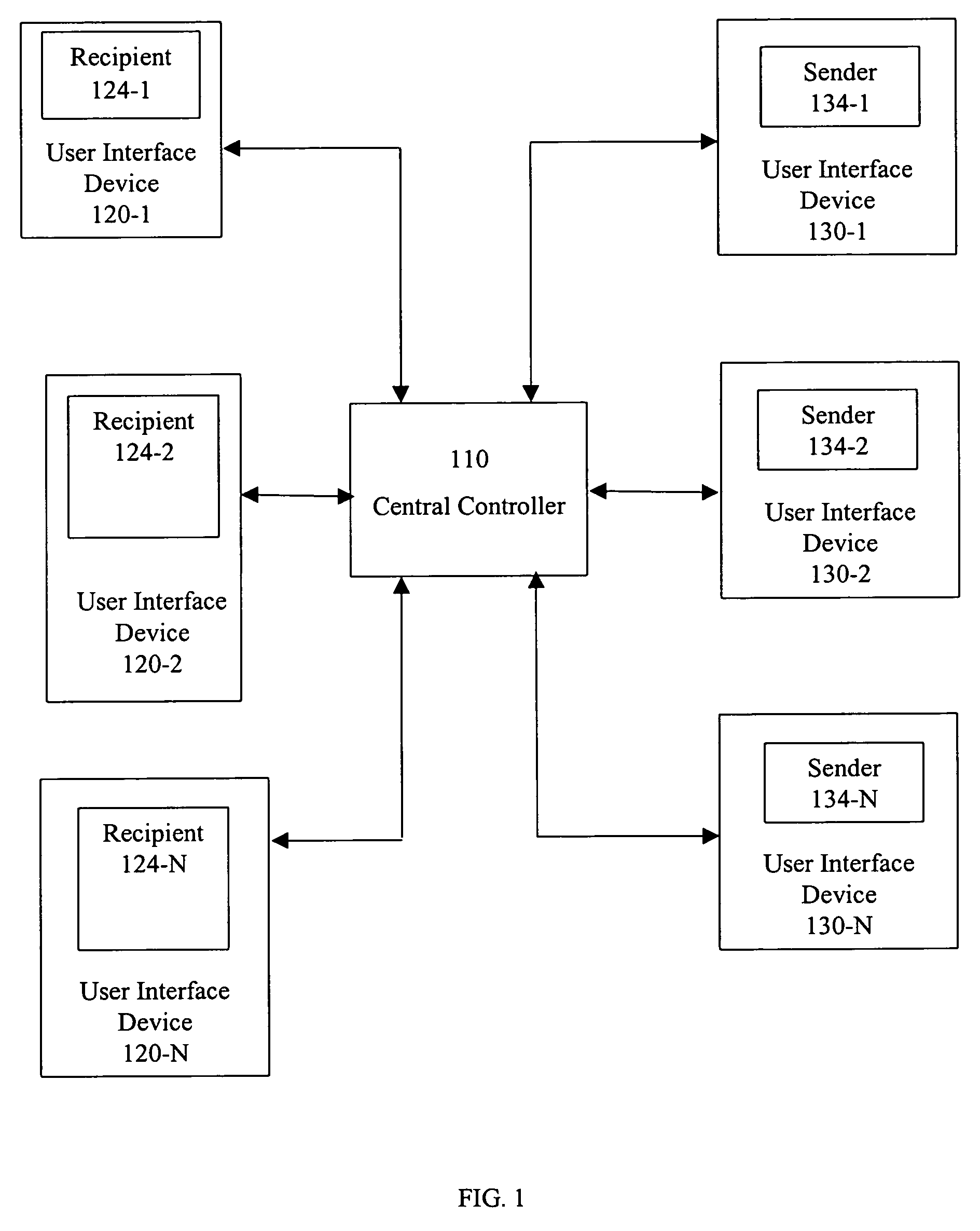

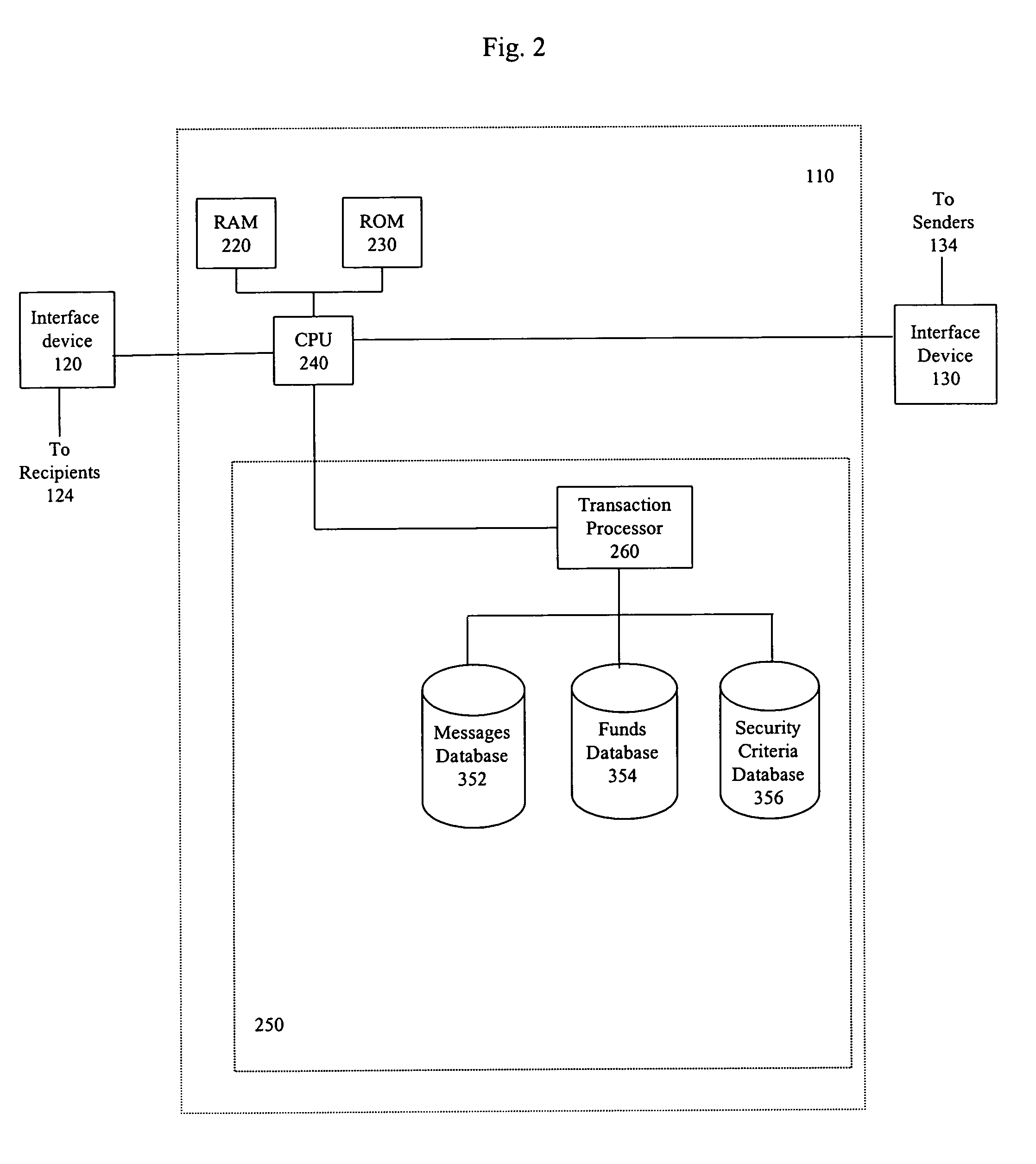

System and method for secure electronic fund transfers

A system and method for allowing simplified electronic transfer of funds in files subject to sender-defined access constraints. In one aspect of the system and method, a digital currency file is transmitted as an attachment to an electronic message. The sender of the digital currency file defines the level of security associated with the file, i.e., what the recipient must provide to access the funds.

Owner:NAT CENT FOR MFG SCI +1

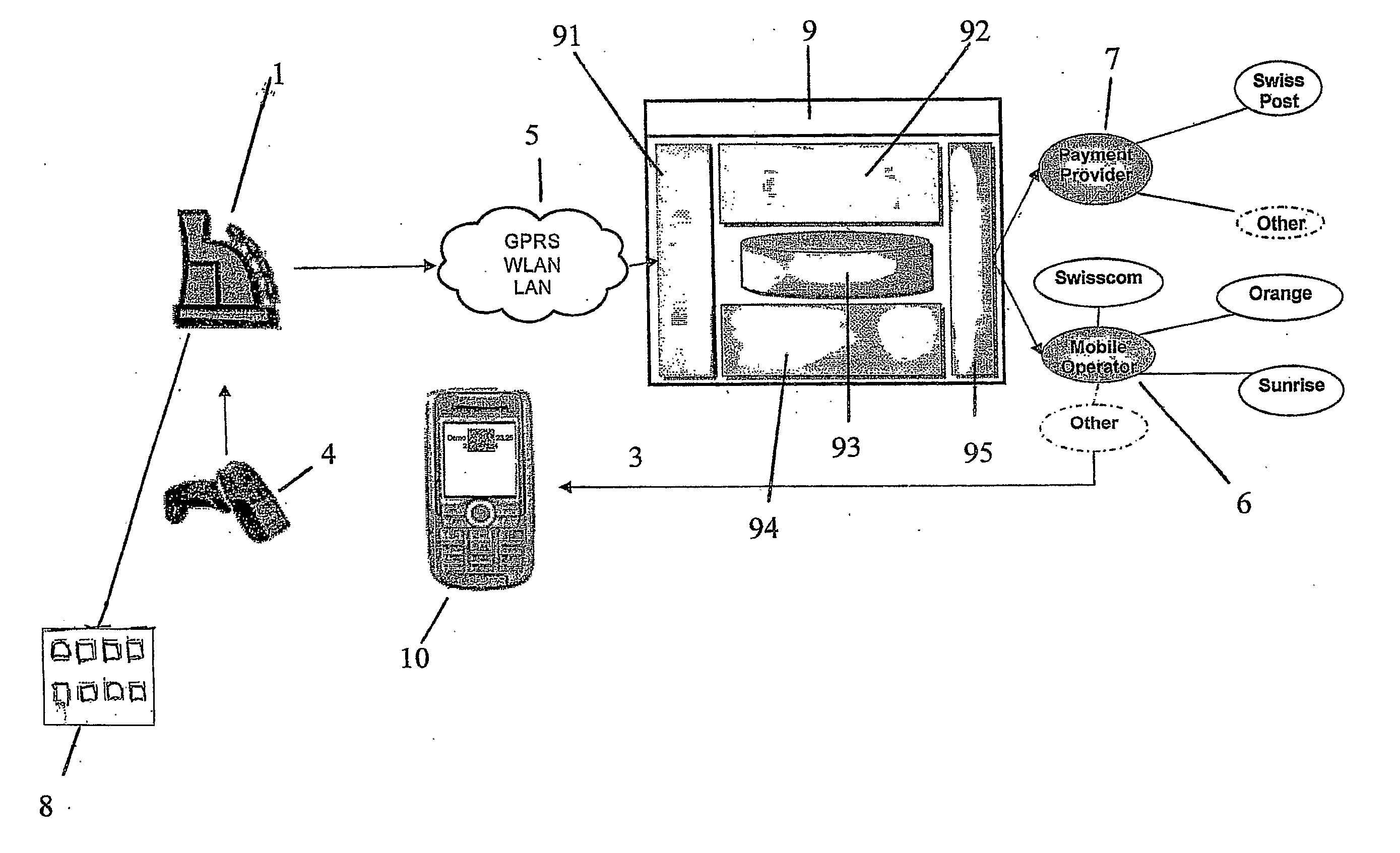

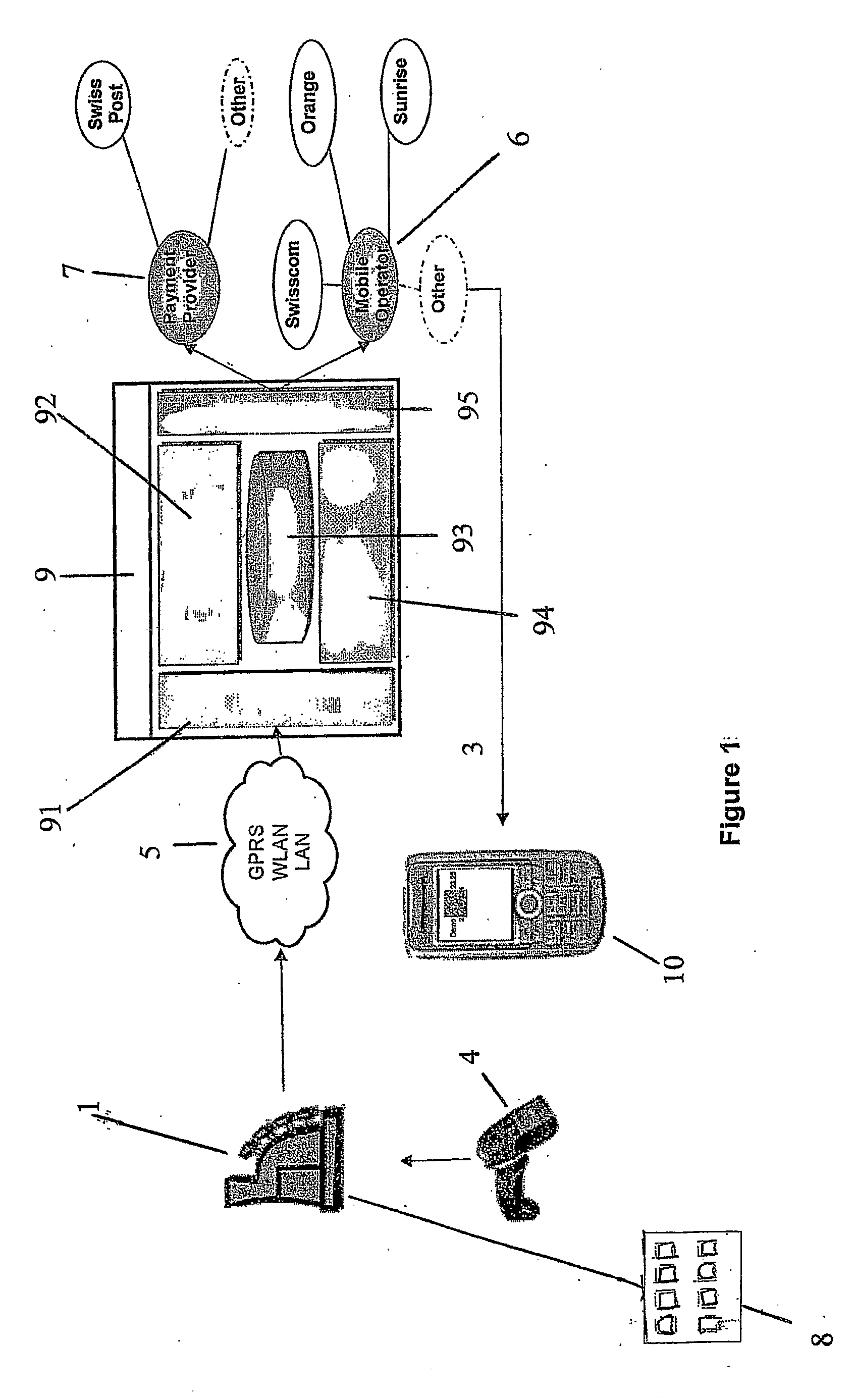

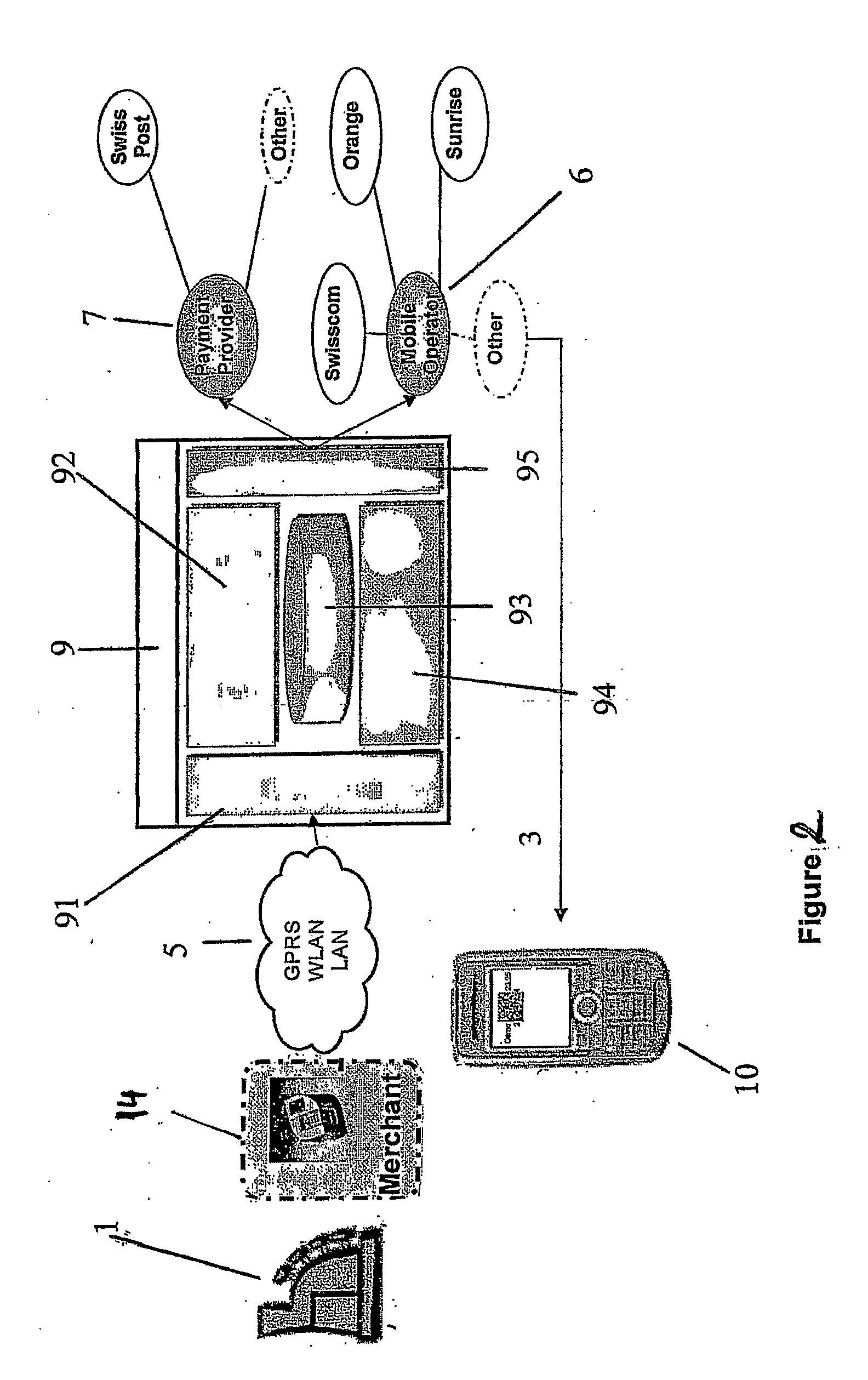

Communication System And Method Using Visual Interfaces For Mobile Transactions

InactiveUS20080091616A1Easy and simple and secureImpairing safetyCash registersElectronic credentialsElectronic funds transferAuthorization

The invention relates to a system and a method for providing a mobile transaction, such as a payment, the system including: a first means at a point of sale for entering transaction data and customer data and having a unique ID associated therewith; and a mobile transaction platform connected via a first link to the first means, the mobile transaction platform being adapted to receive the transaction data, the customer data and the unique ID, and to route the transaction data, the customer data and the unique ID to a payment provider for obtaining authorization for an electronic fund transfer at the point of sale, the mobile transaction platform being further adapted to provide the authorization information of the payment provider via a second link, which is distinct from the first link, to a mobile device of the customer, wherein the authorization information is in form of a machine readable visual symbol, the first means being adapted to read and decode the visual symbol from the mobile device and to send the decoded visual symbol via the first link to the mobile transaction platform for finalizing the transaction.

Owner:UNISYS CORP

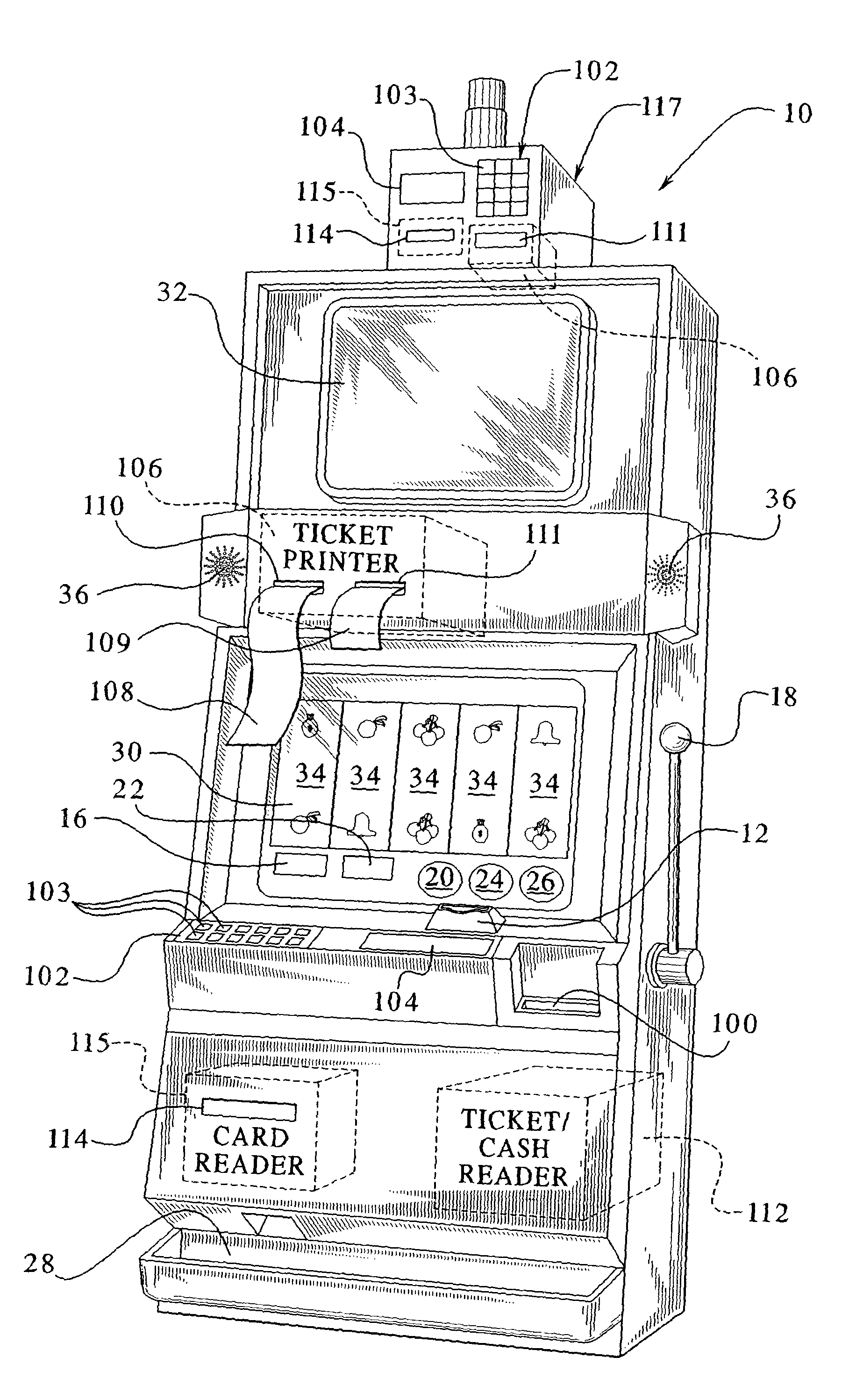

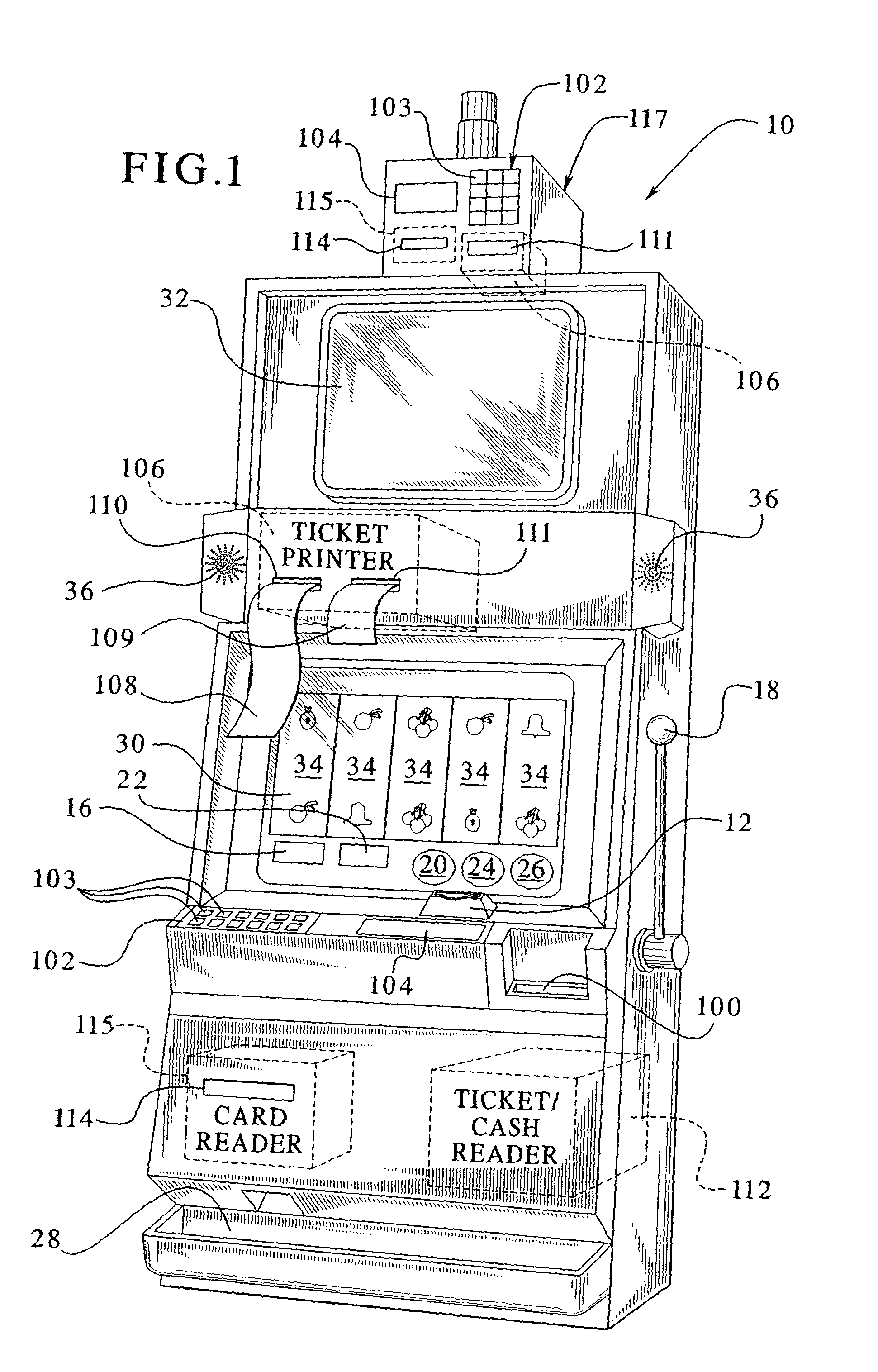

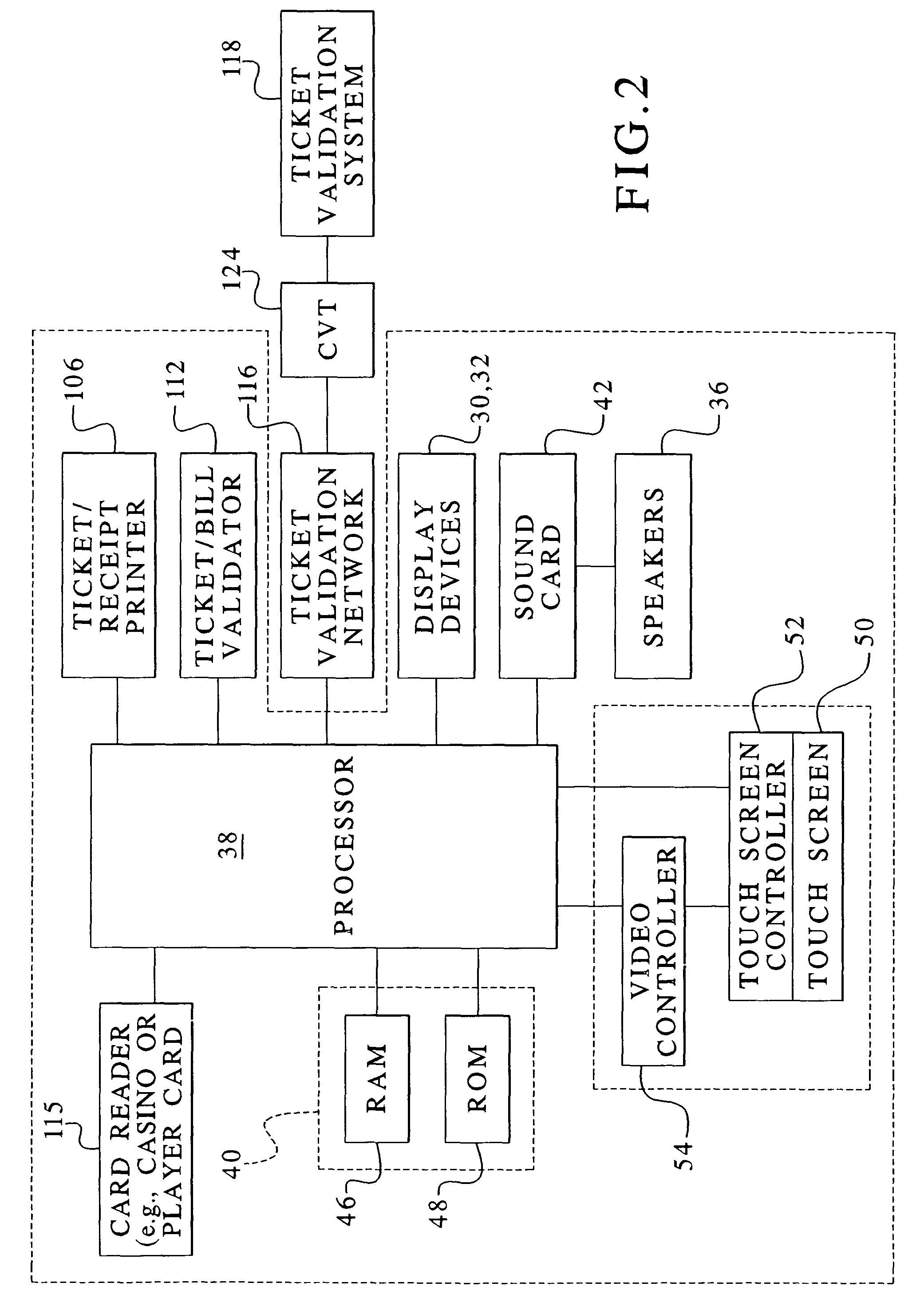

Gaming device having an electronic funds transfer system

ActiveUS7819742B2Apparatus for meter-controlled dispensingReceipt giving machinesDisplay deviceCard reader

A system, method and gaming device having a card reader and a receipt printer are provided. One processor of the gaming device communicates with a receipt printer and plays a game program. Another processor operates as part of an electronic funds transfer control unit that communicates with a card reader, keypad and display for prompting the player to enter fund transfer card information. The control unit sends out fund requests over a wide area network to a remote fund repository. If the repository approves of a fund request, the approval travels back to the ticket validation system, which instructs the gaming device to: (i) issue a direct transfer of funds via the credit meter, a hopper or a lottery and (ii) issue a receipt for the transfer to the player.

Owner:IGT

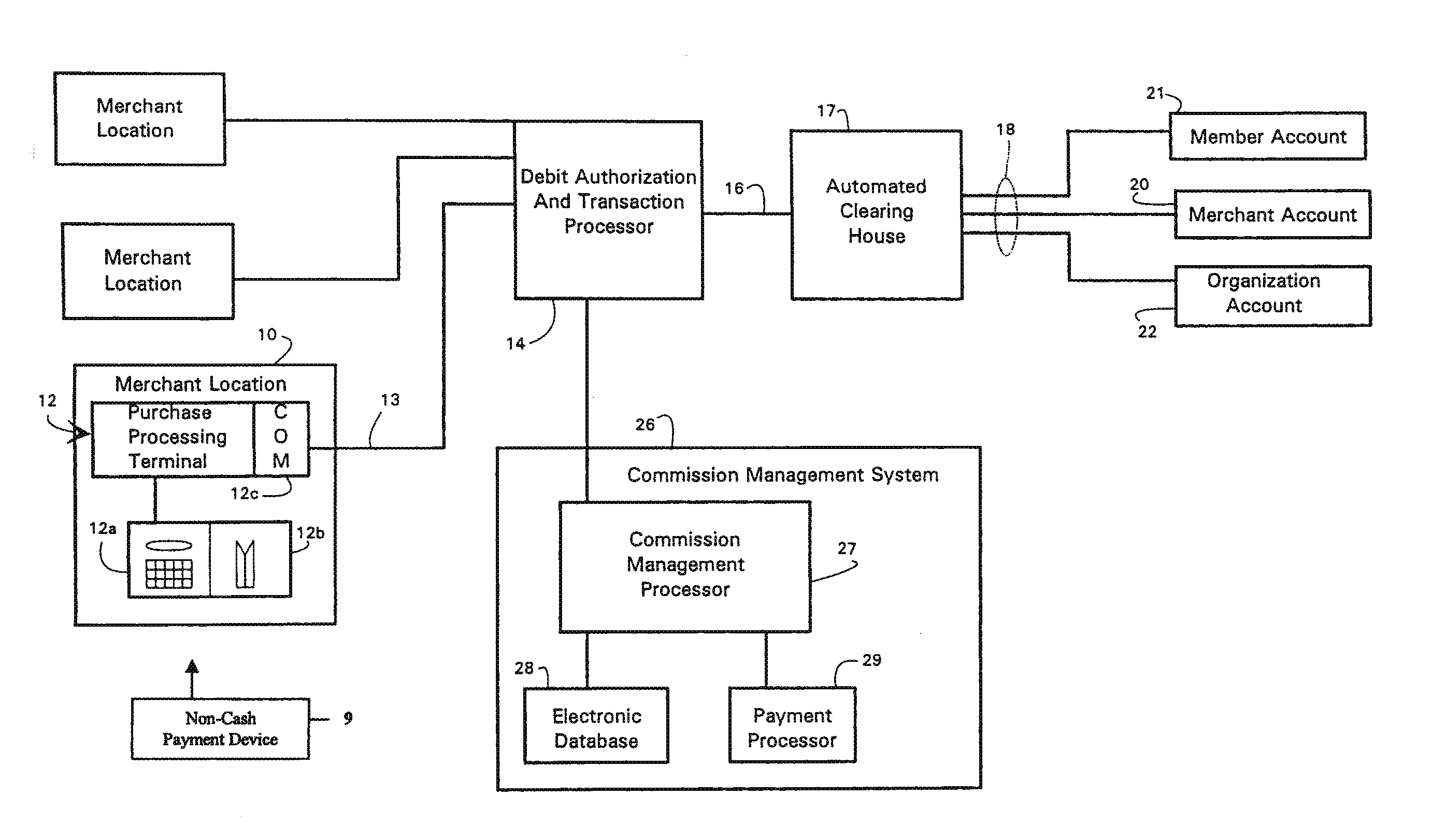

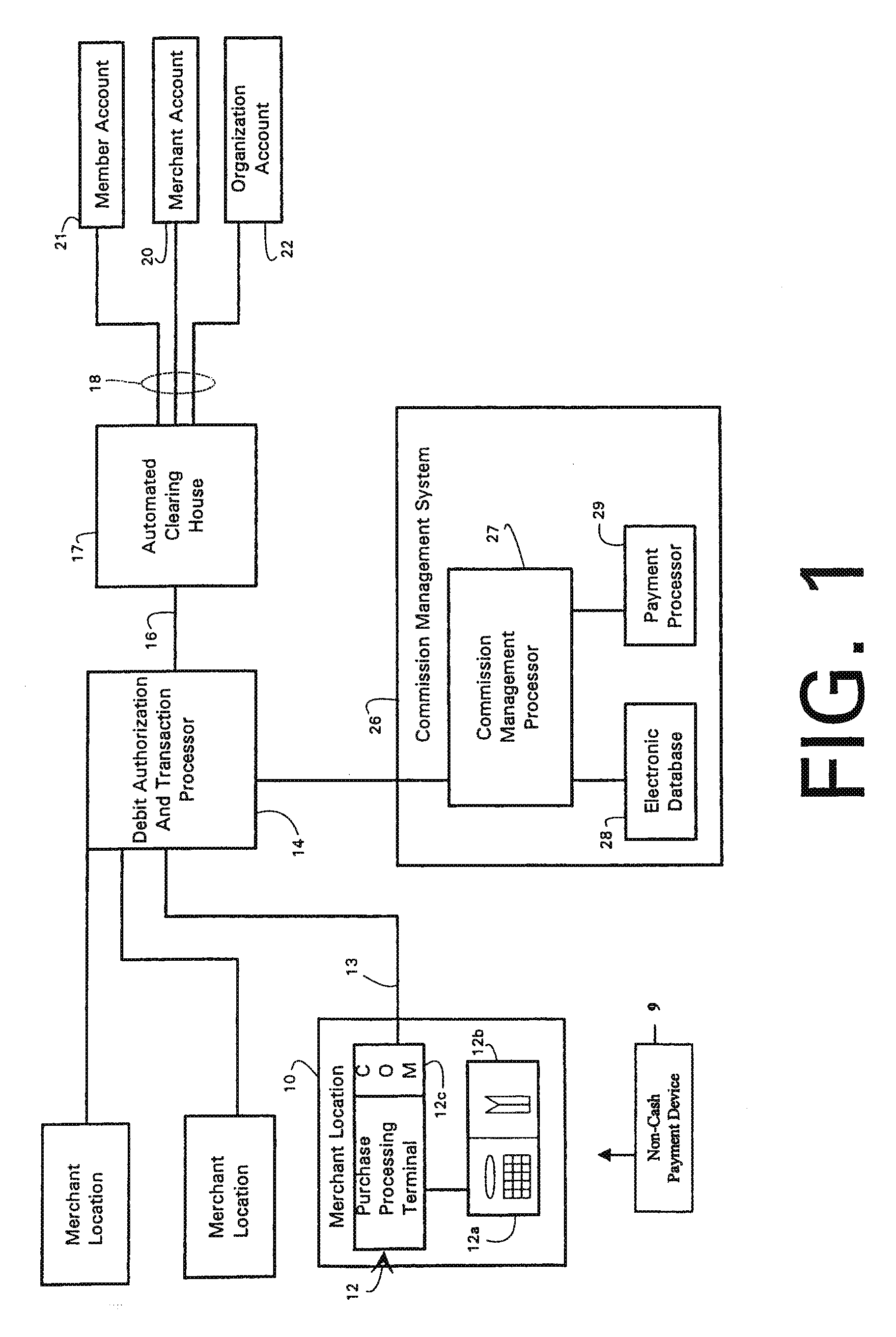

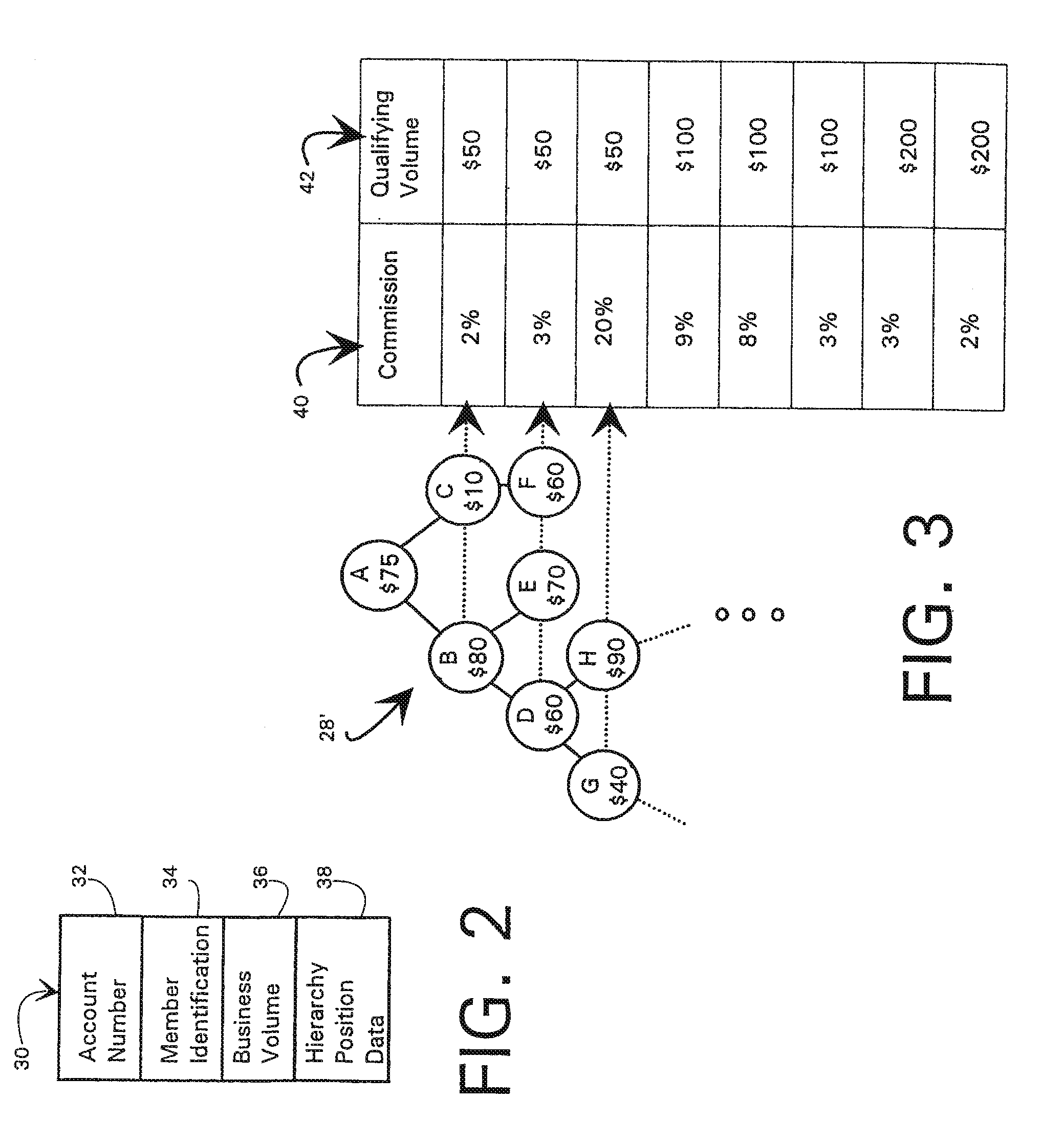

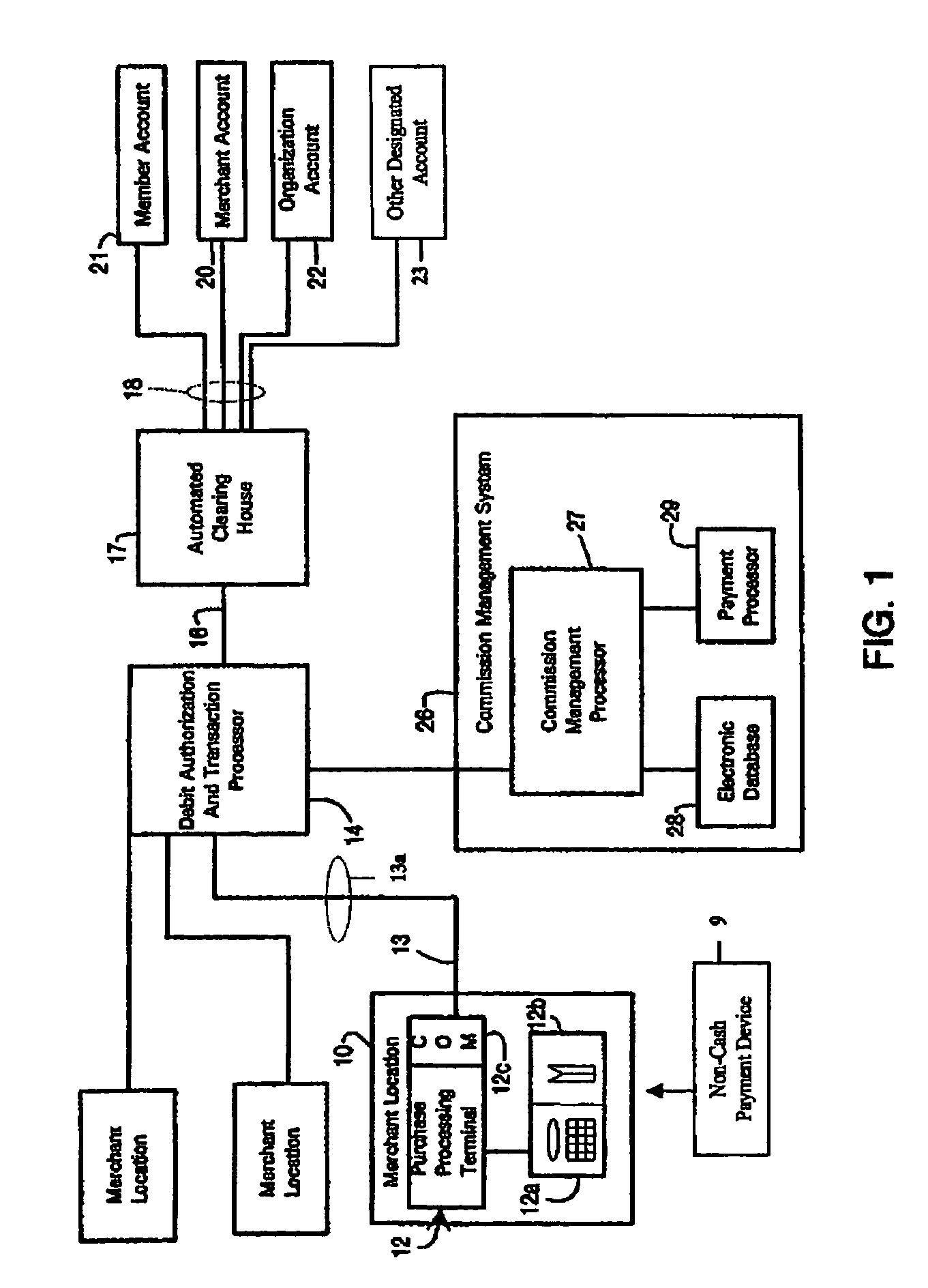

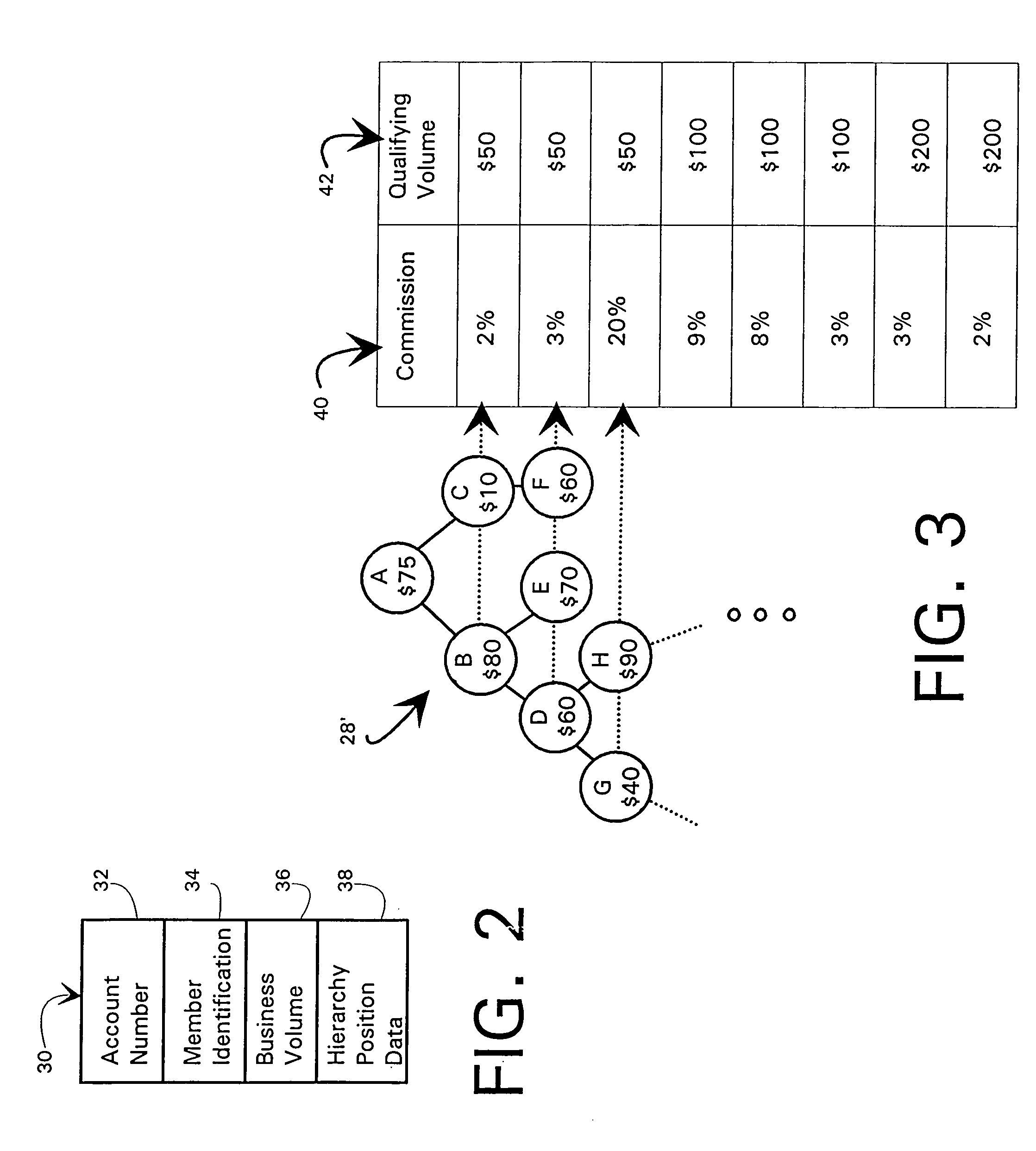

Non-cash transaction incentive and commission distribution system

InactiveUS20090216640A1Complete banking machinesDiscounts/incentivesNetwork structureDistribution system

An electronic fund transfer system is disclosed wherein commissions for point-of-sale purchase transactions are determined and distributed to members of an organizational network for promoting use of a non-cash payment device that is tangible for effecting purchase transactions. Purchase data is electronically transmitted from the point-of-sale to an automated clearing house for effecting fund transfers to prepare the purchase, and also to a commission management system. The commission management system maintains an electronic database reflecting the structure of the organizational network, and further determines the distribution of purchase commissions according to a predetermined schedule of proportions relating to the position and business volume of each member of the network. The commission management system further comprises a payment processor for effecting commission payments to the members or to a designated sponsor on a scheduled basis.

Owner:MASI LARRY A

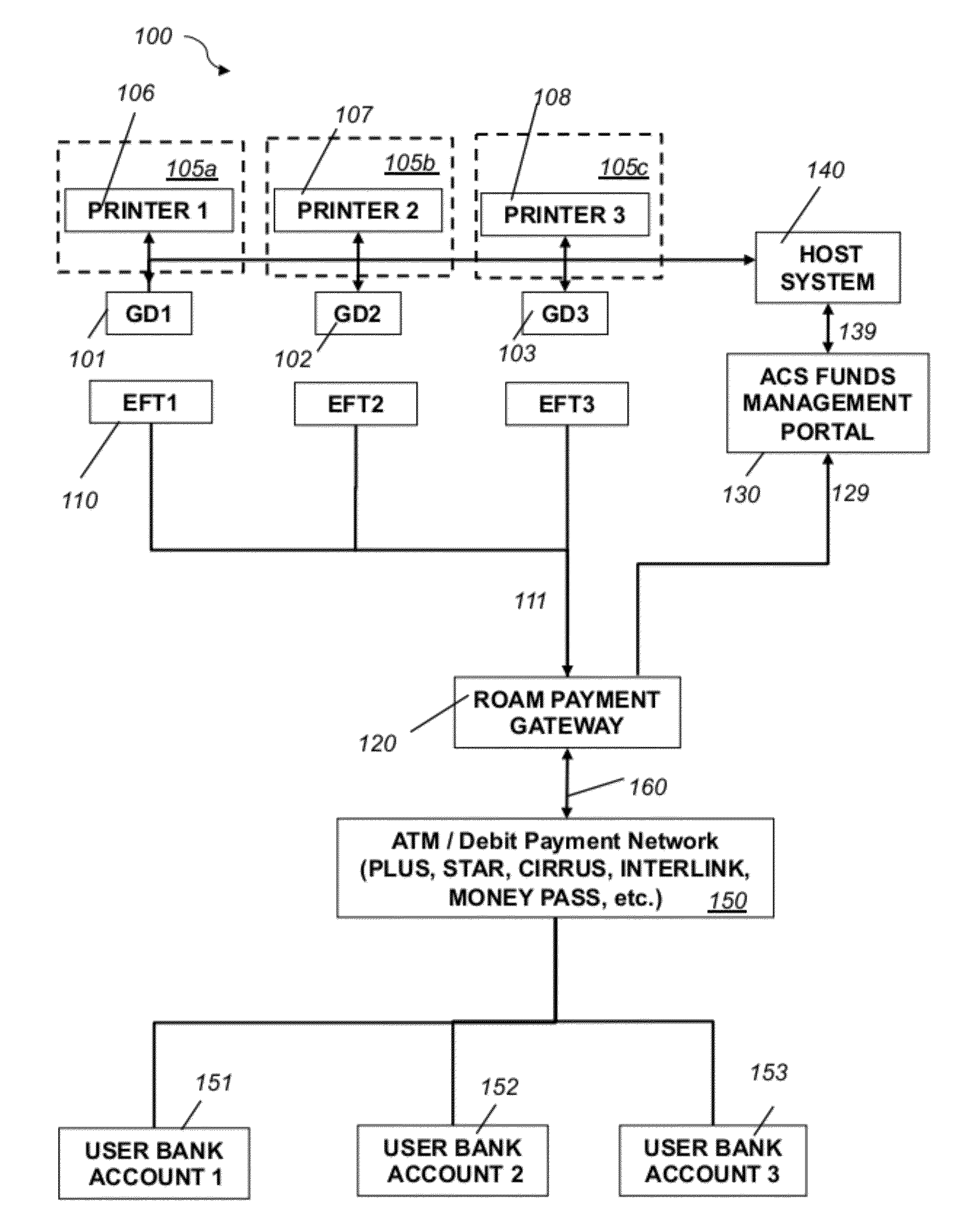

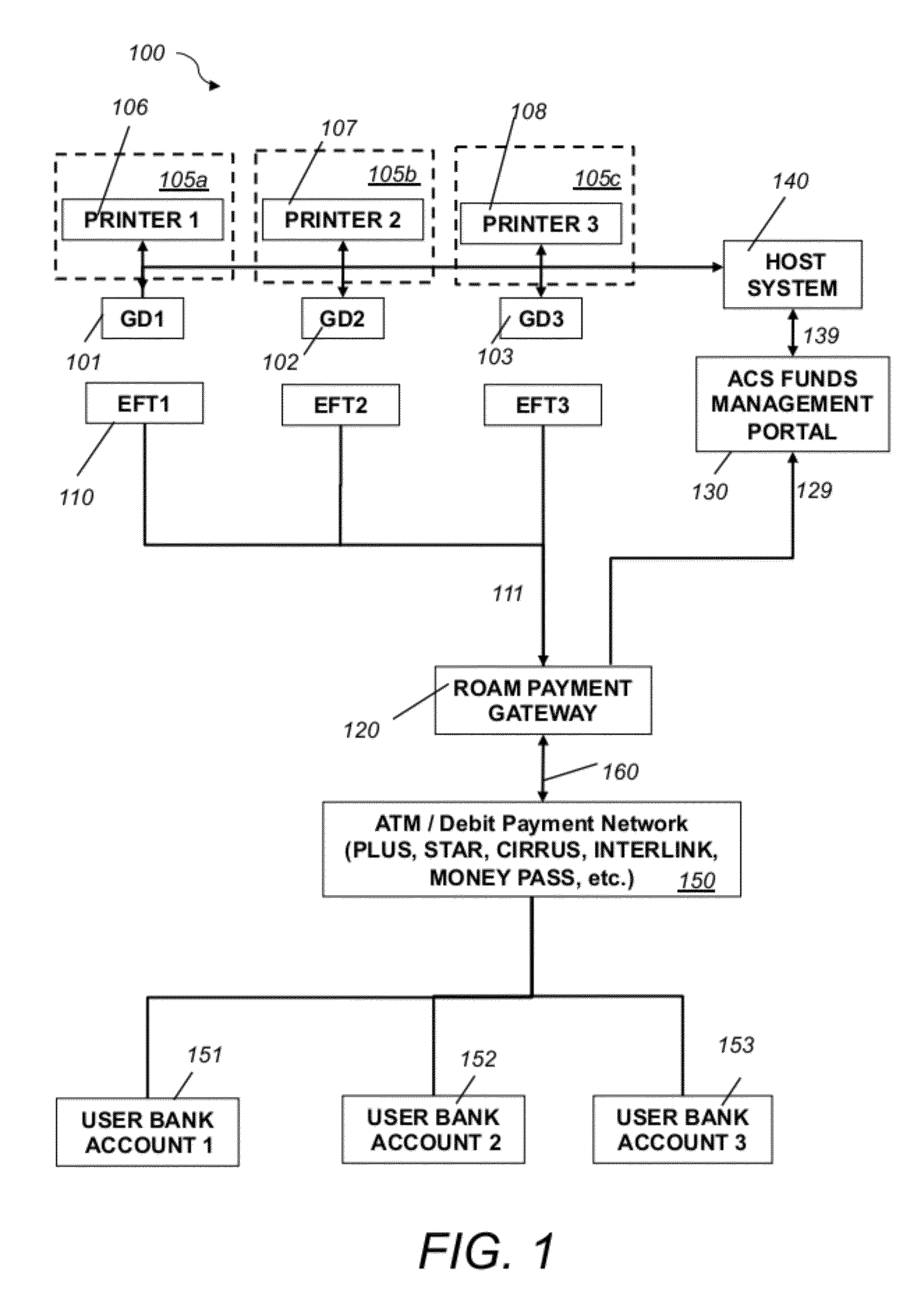

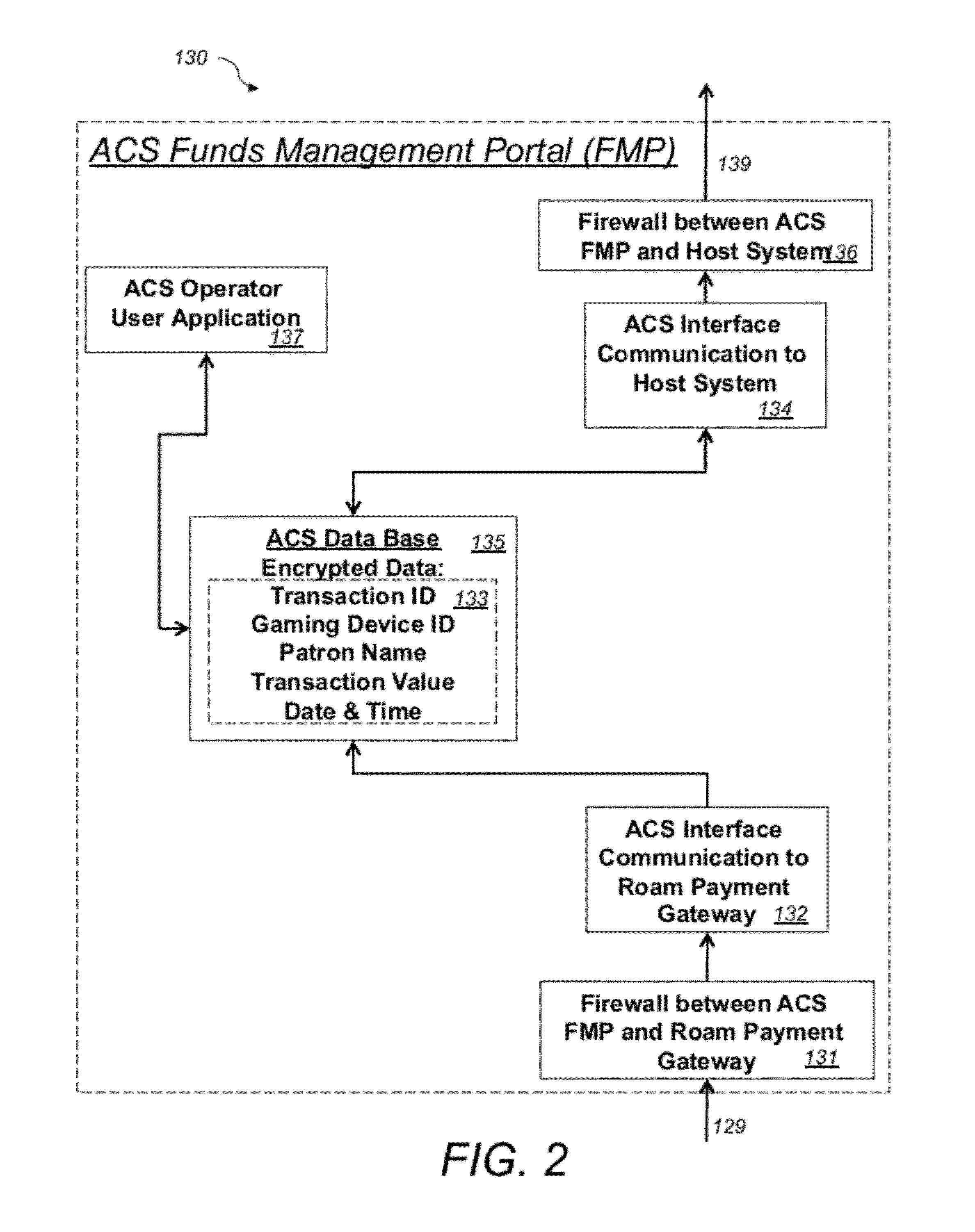

System and method for electronic fund transfers for use with gaming systems

An electronic fund transfer (EFT) system for managing and transferring electronic funds from a user's financial account to a credit system includes a credit system configured to dispense credit to a user via physical or electronic credit means, an electronic fund transfer (EFT) device, a secure payment gateway configured to connect to the user's financial accounts via a financial asynchronous transfer mode (ATM) network, a host system connected to the credit system via a local network, a funds management portal connected to the host system and the secure payment gateway, and means for transferring electronic funds from the user's financial account to the credit system via the secure payment gateway. The funds management portal accounts and reconciles the transferred electronic funds. All communications between the secure payment gateway and the host system pass through the funds management portal. The EFT device includes a secure client-side application for receiving instructions from the user for transferring electronic funds from the user's financial account to the credit system and means for transmitting the fund transfer instructions to the user's financial account. The EFT device is configured to connect to the secure payment gateway and to communicate with the user's financial account and to transmit the instructions for transferring electronic funds from the user's financial account to the credit system via the secure payment gateway.

Owner:AUTOMATED CASHLESS SYST INC

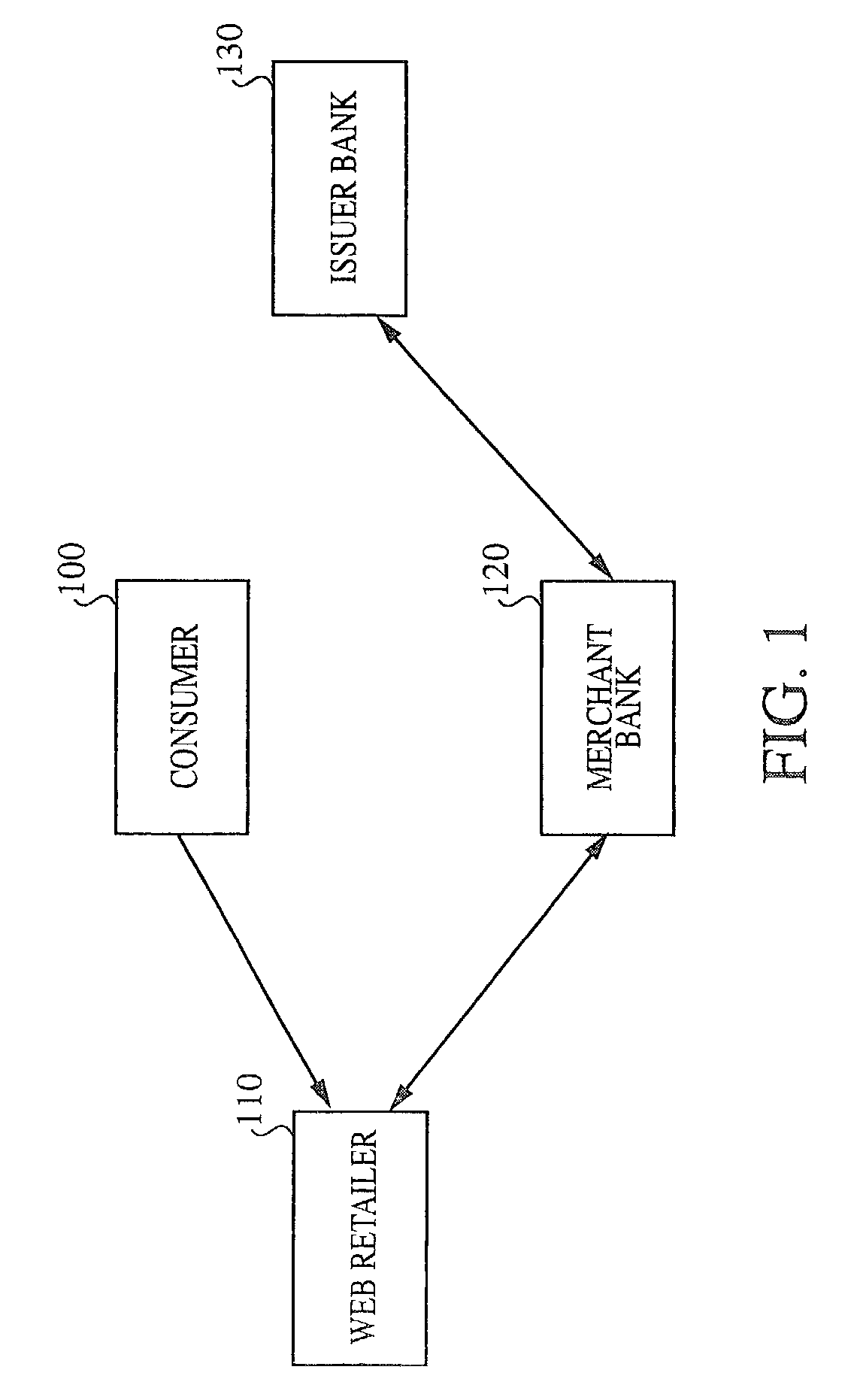

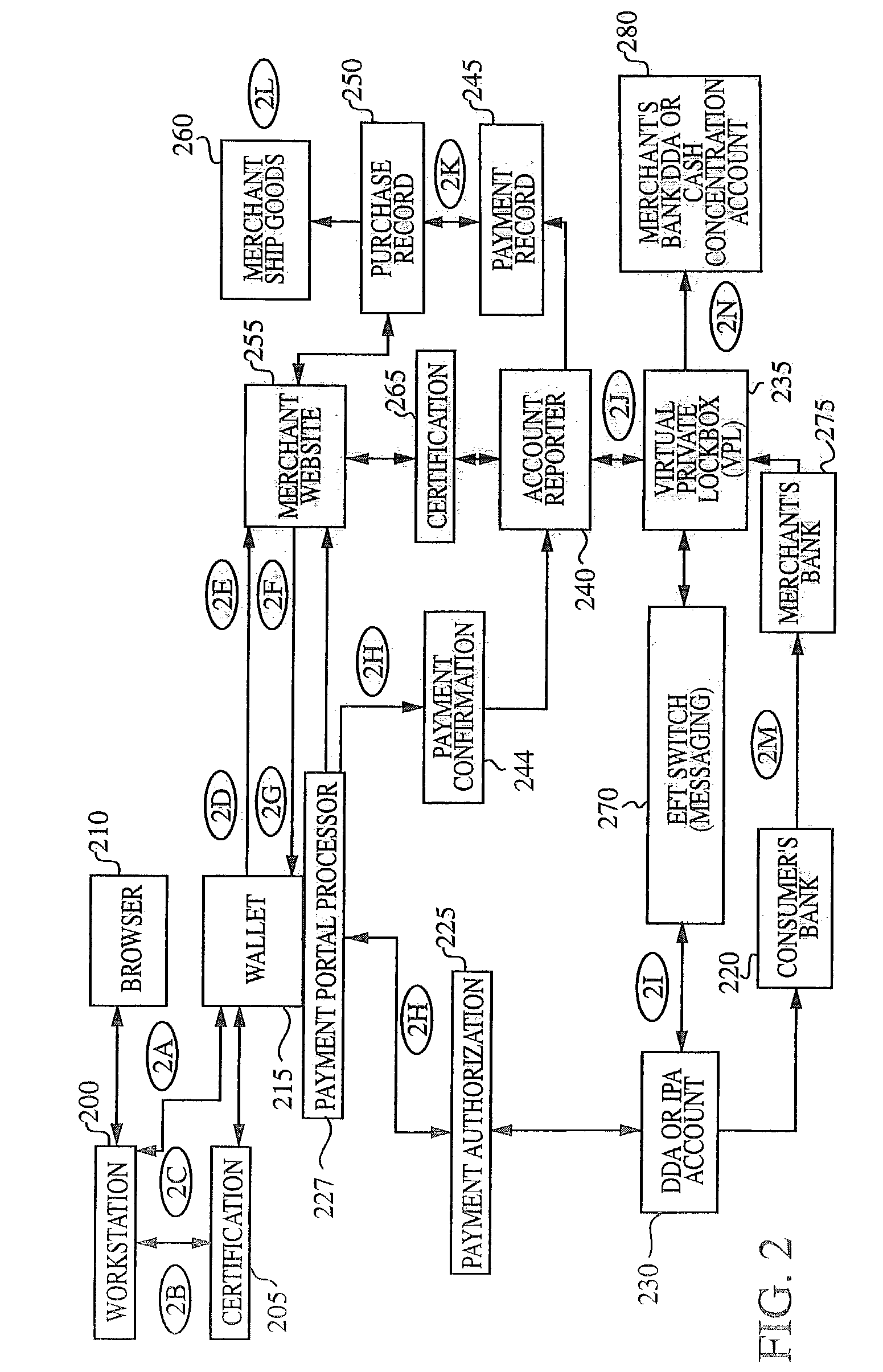

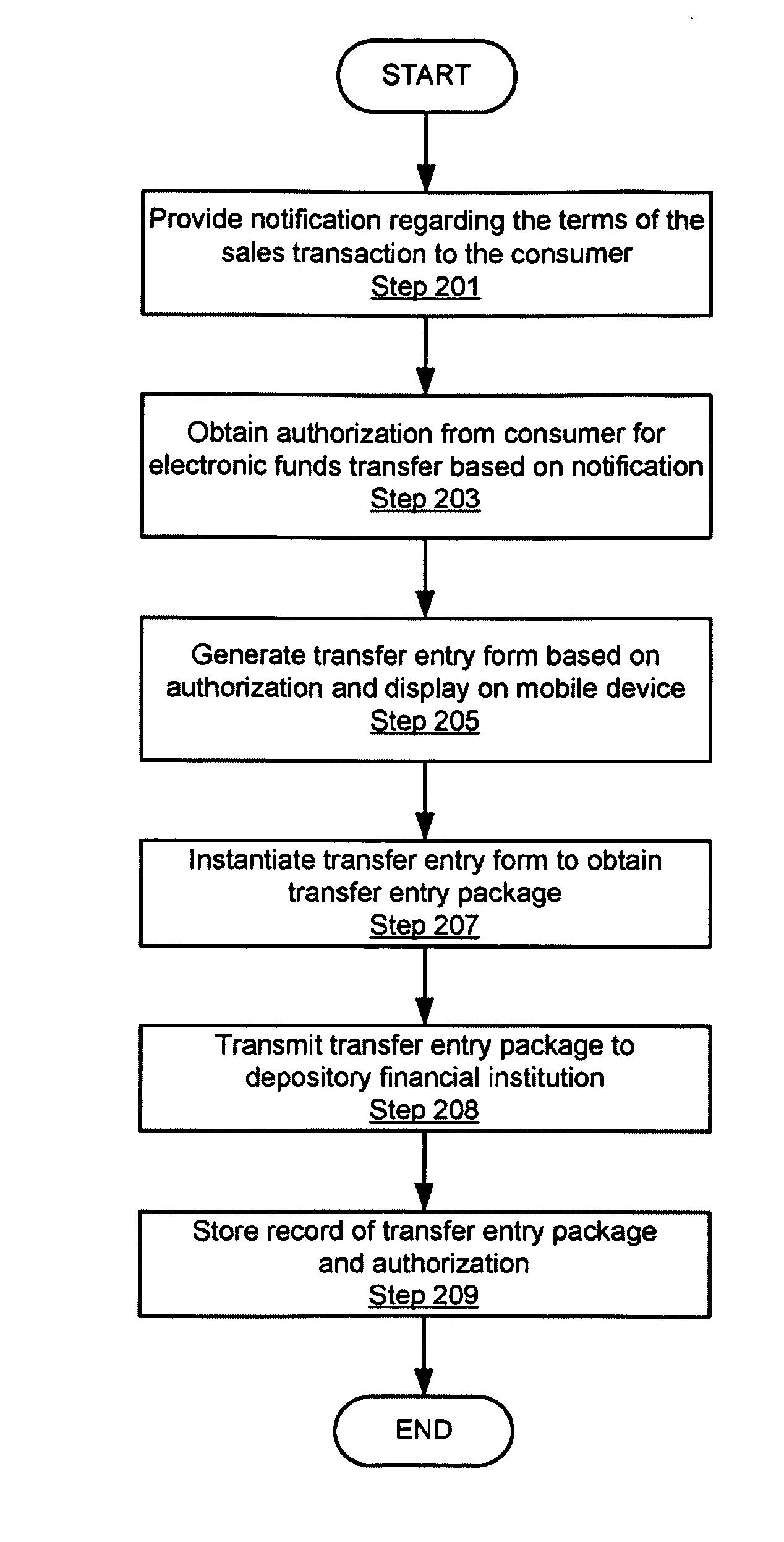

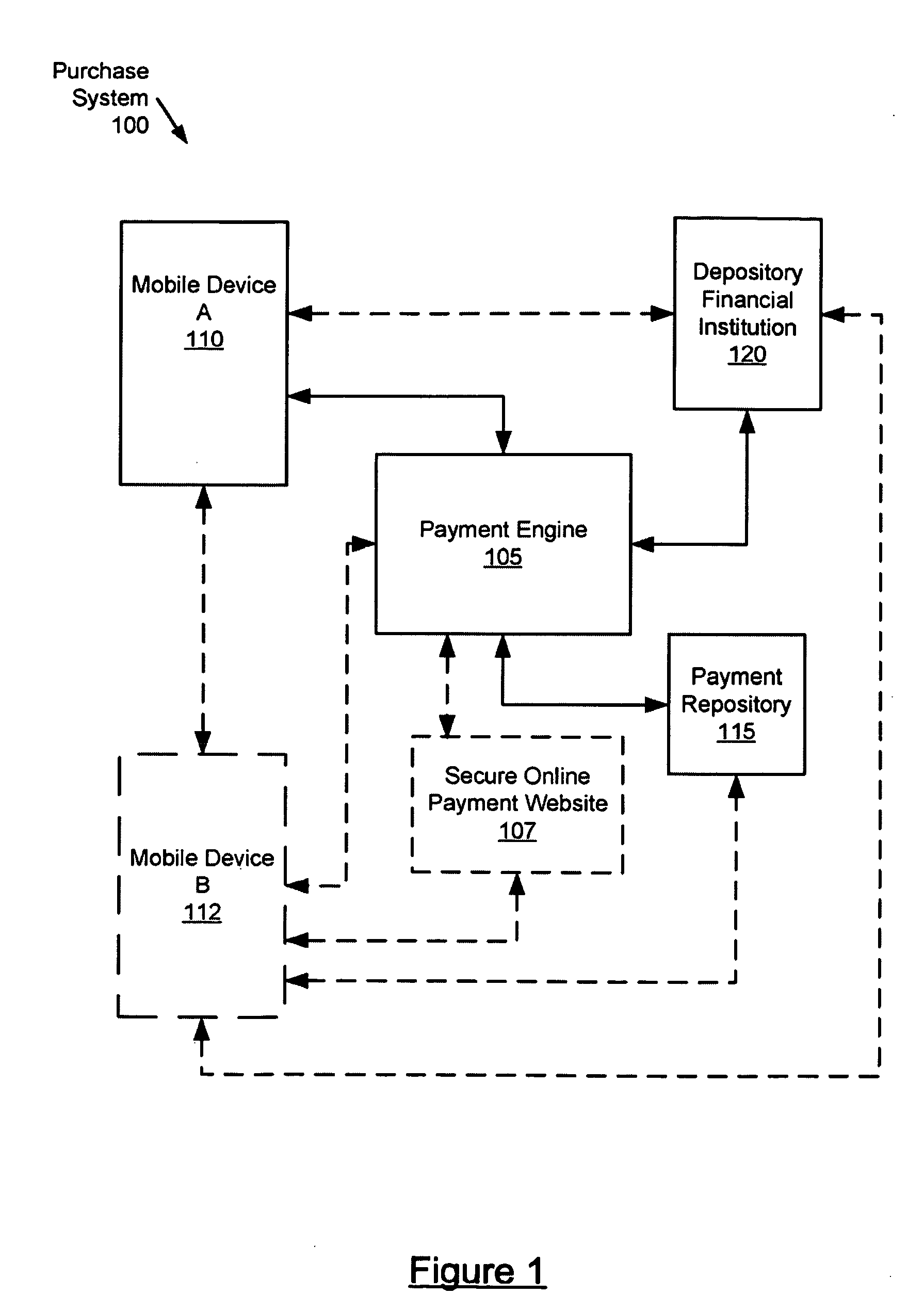

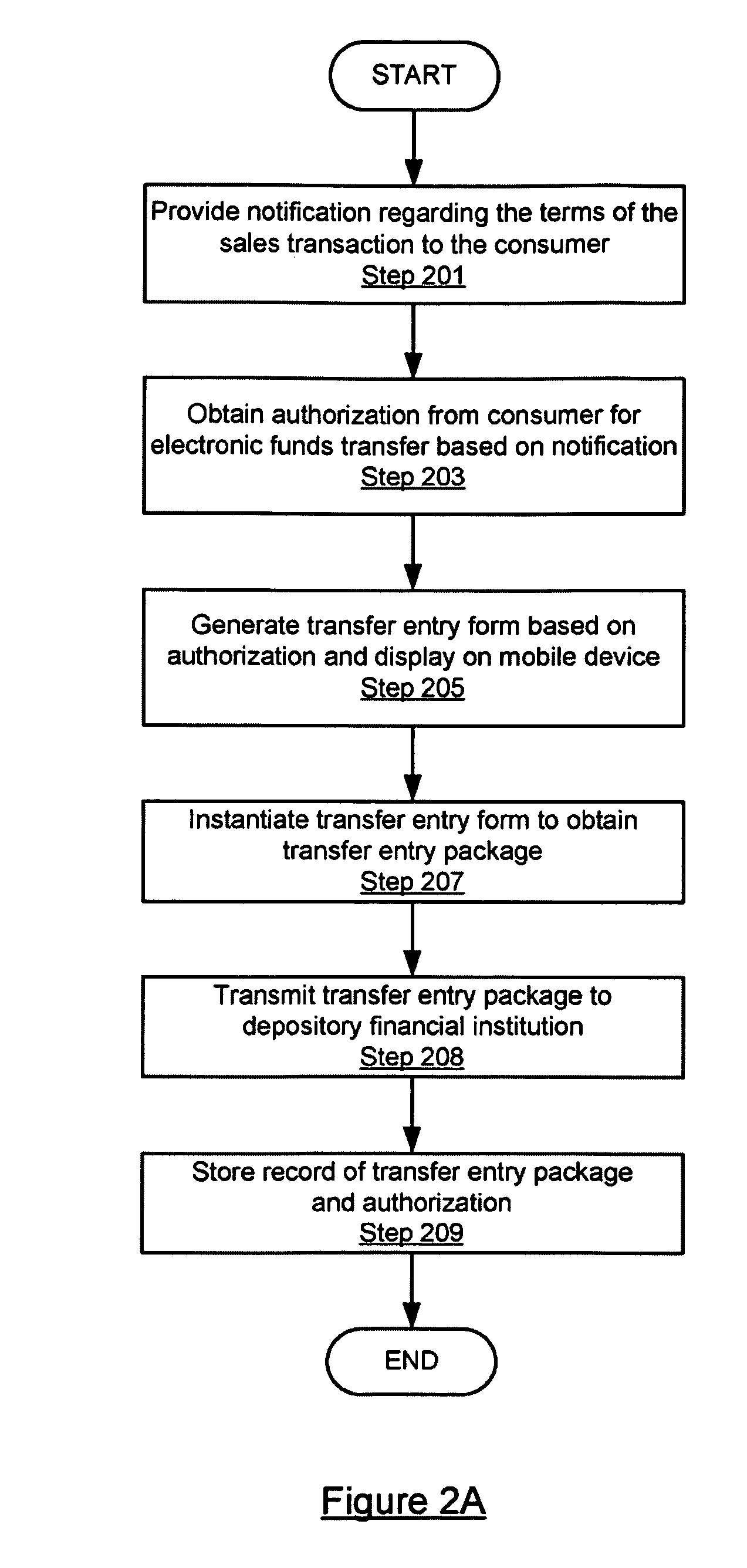

Method and system for processing internet payments using the electronic funds transfer network

InactiveUS20130317984A1Safe, sound, and secureFinanceAnonymous user systemsFinancial transactionNetwork processing

Embodiments of the invention include a method and system for conducting financial transactions over a payment network. The method may include associating a payment address of an account with an account holder name, the account residing at a financial institution and the associated payment address of the account configured to allow withdrawals by the account holder only and to allow a plurality of deposits to be made at different times. The method further includes freely publishing the payment address and making it available to users of an internet portal or search engine. The method further includes receiving data over a network identifying a deposit to be made to the account, assigning the deposit to the account using the payment address, and notifying the payer of the assignment. At least one directory is used for associating the account holder with the payment address.

Owner:JPMORGAN CHASE BANK NA

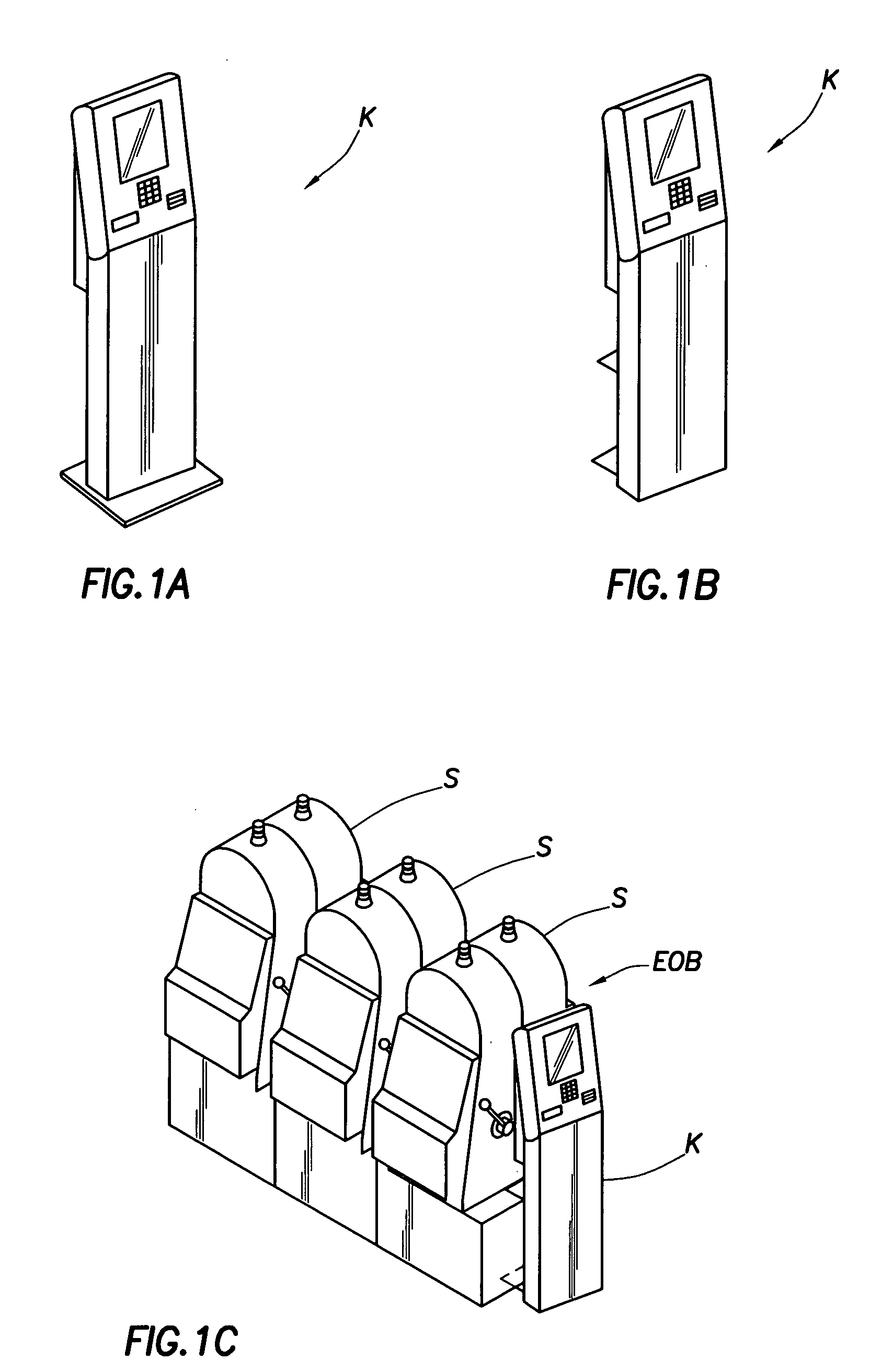

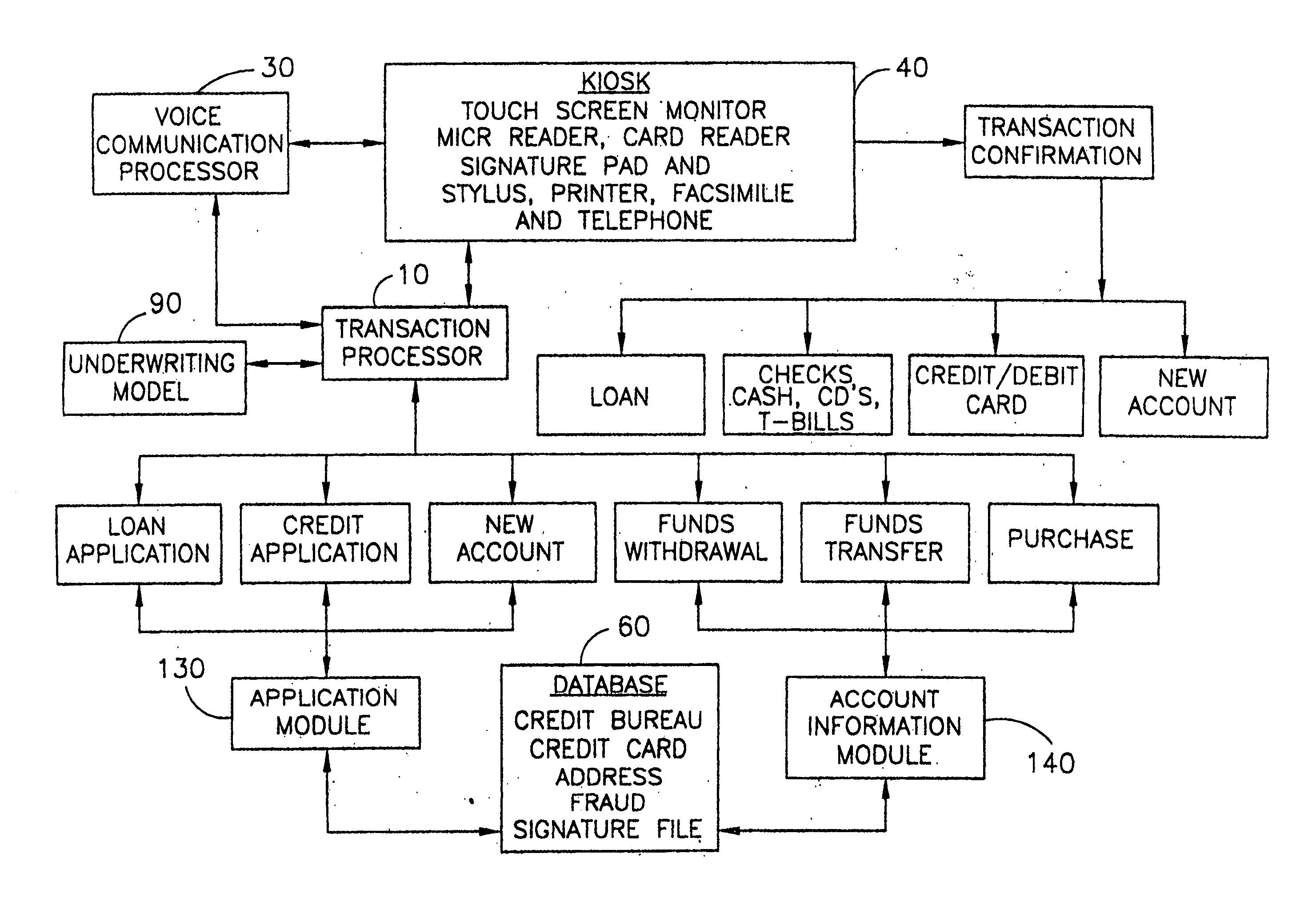

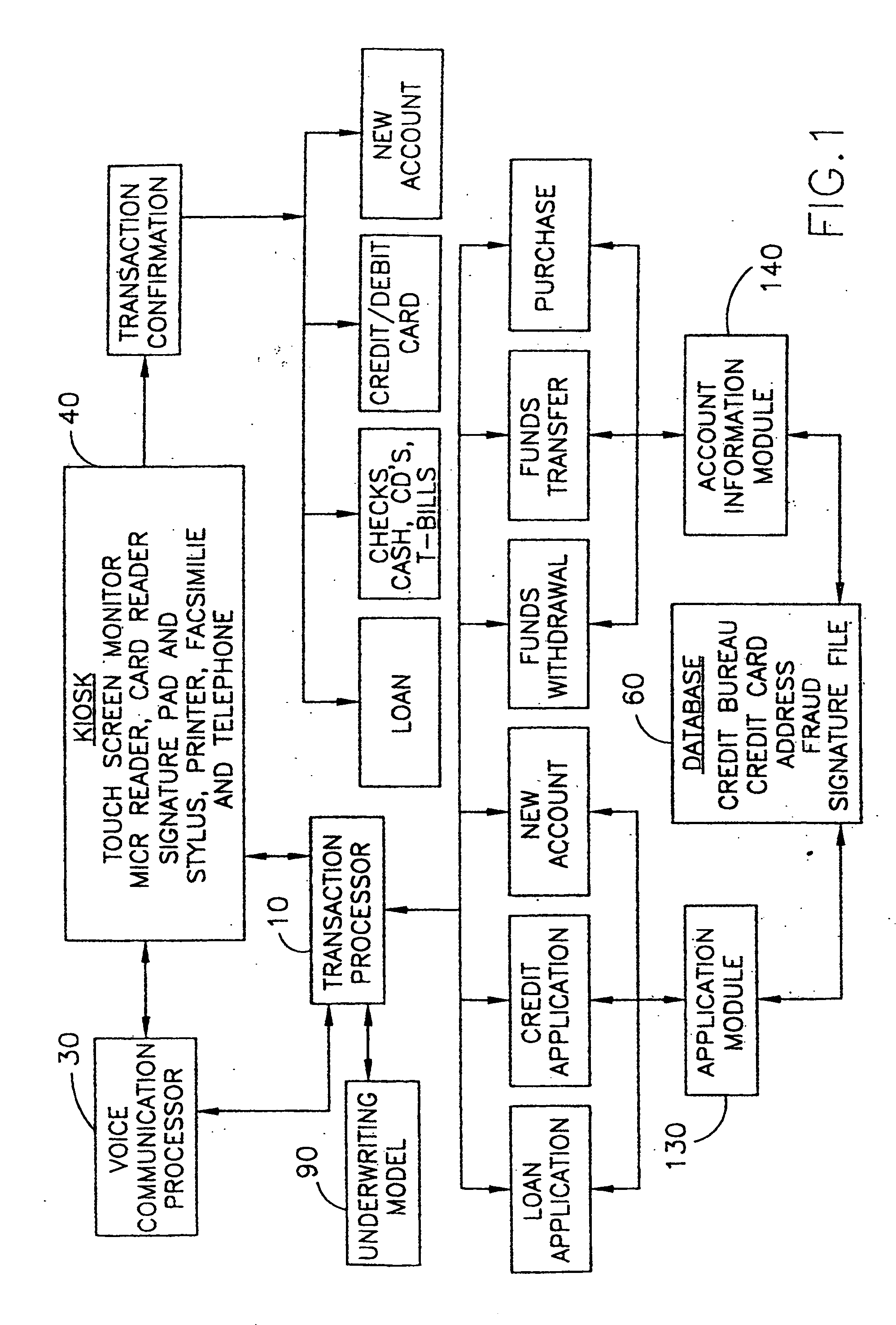

Automatic financial account processing system

InactiveUS20050038737A1Save processing timeReduce errorsComplete banking machinesFinanceDeposit accountDocumentation procedure

A method and apparatus for closed loop, automatic processing of typical financial transactions, including loans, setting up checking, savings and individual retirement accounts, obtaining cashier's checks, ordering additional checks, issuing credit and debit cards, wire transferring money, and so on. The transactions are provided from a kiosk and controlled by a computer controller interacting with the consumer. In the case of loans, a computer controller helps the consumer in the completion of the application, performs the underwriting, and transfers funds. The computer controller obtains the information needed to process the application, determines whether to approve the loan, effects electronic fund transfers to the applicant's deposit account, and arranges for automatic withdrawals to repay the loan. The computer controller reviews documentation requirements including consumer lending and other required documentation with the consumer and obtains acknowledgment of acceptance of terms by having the consumer sign an electronic signature pad. Copies of documents with a digital photograph are printed out by a printer in the kiosk for the consumer. Finally, the kiosk has the capability of imprinting a credit or debit card in response to a consumer request.

Owner:DECISIONING COM

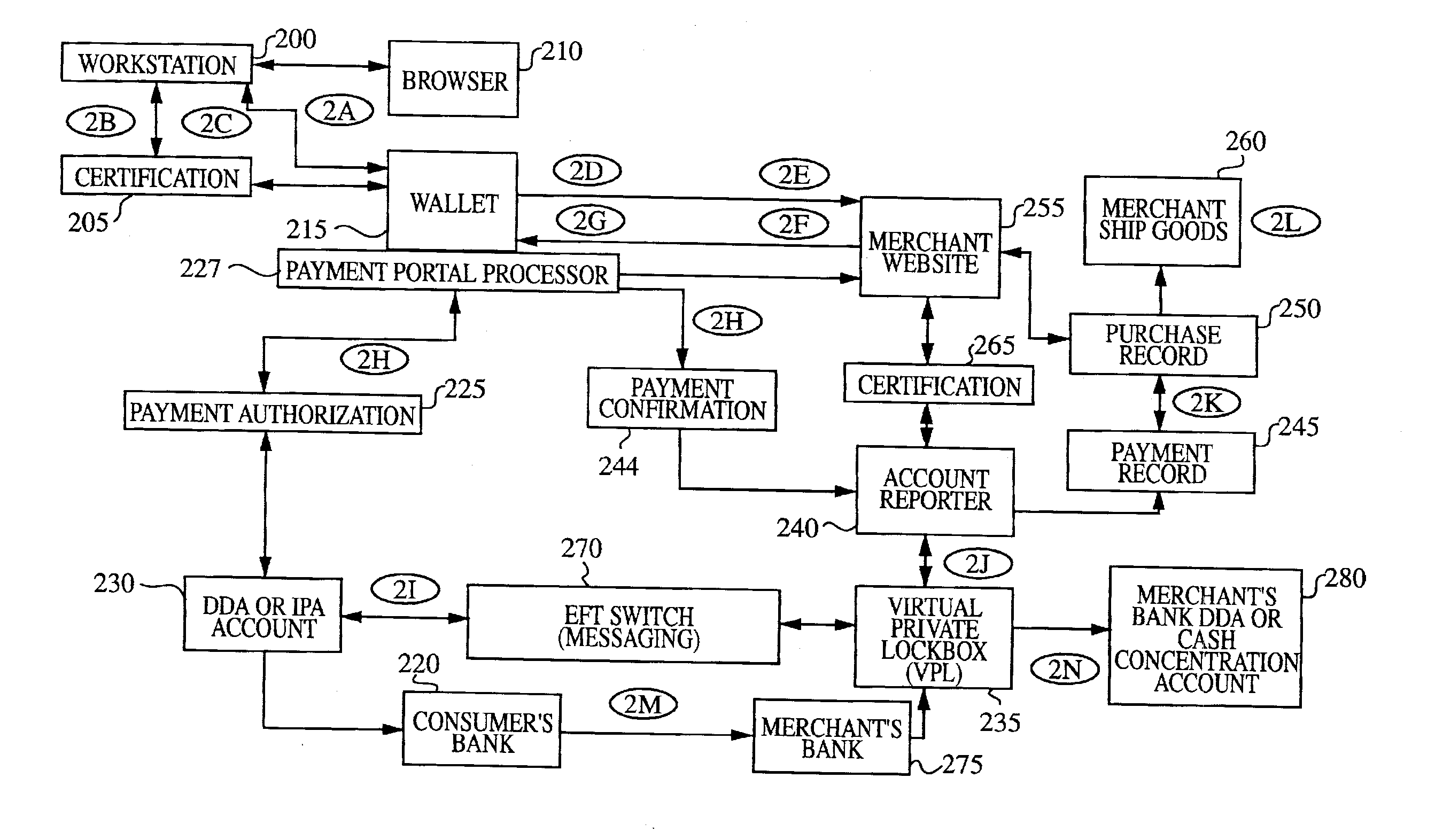

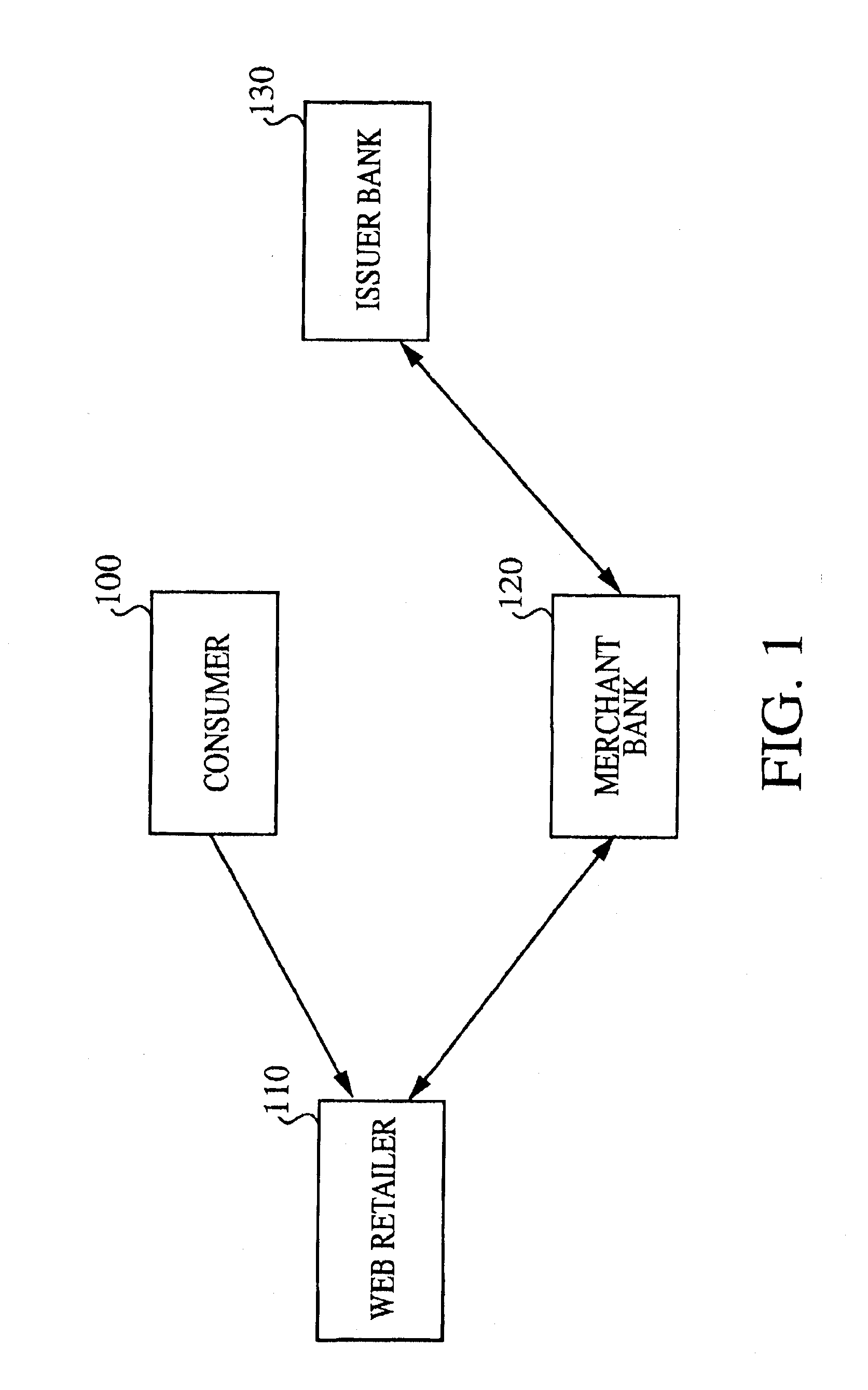

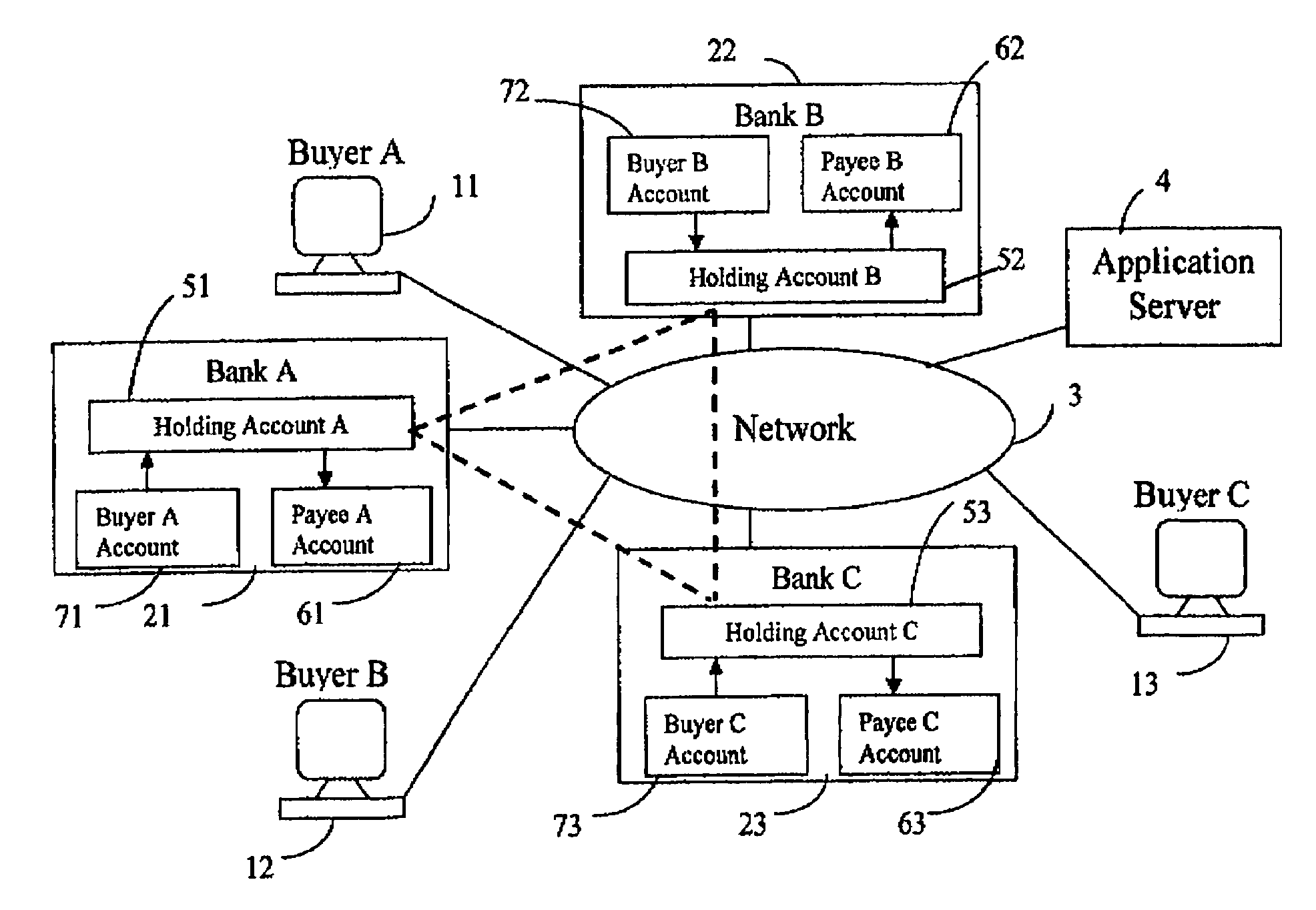

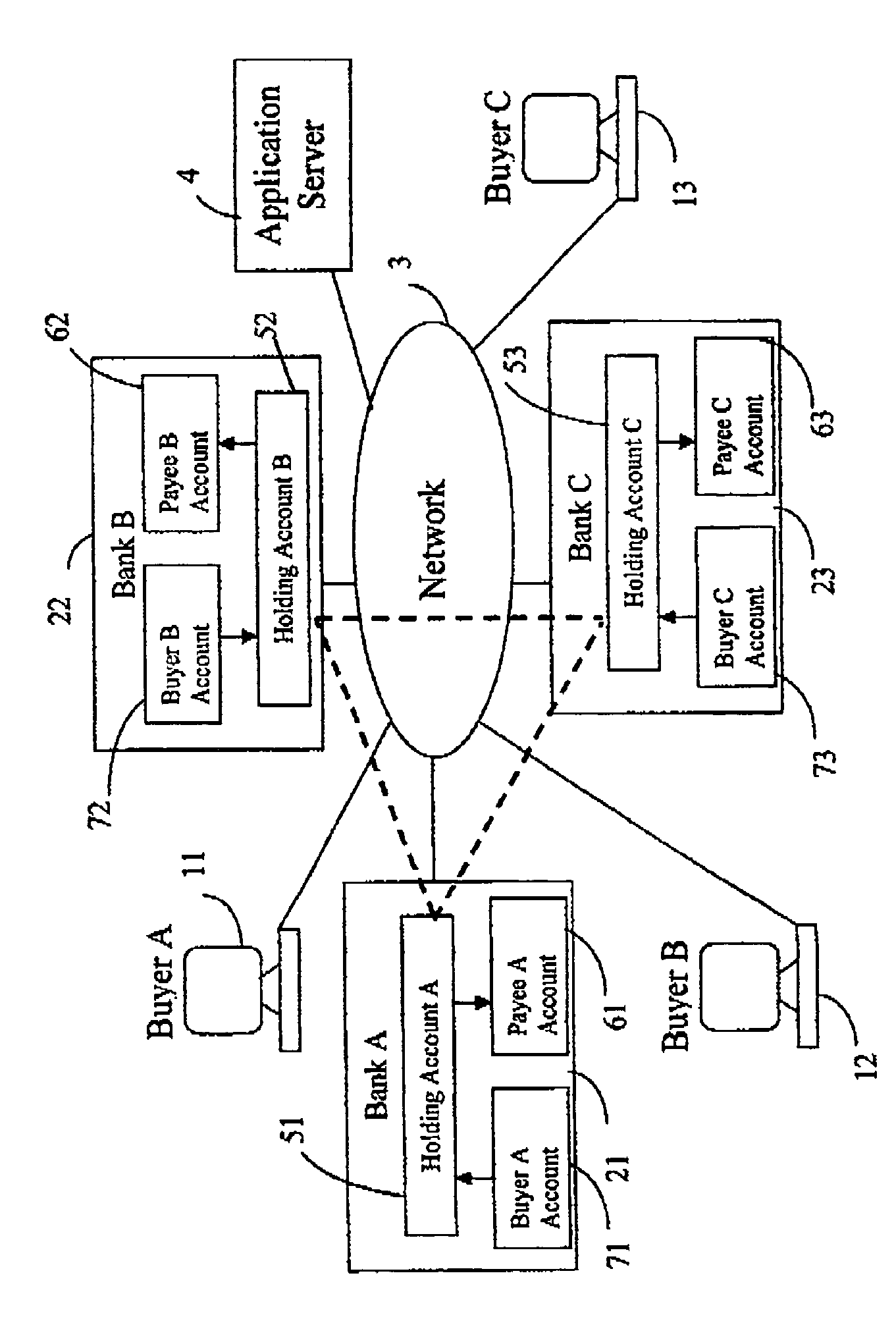

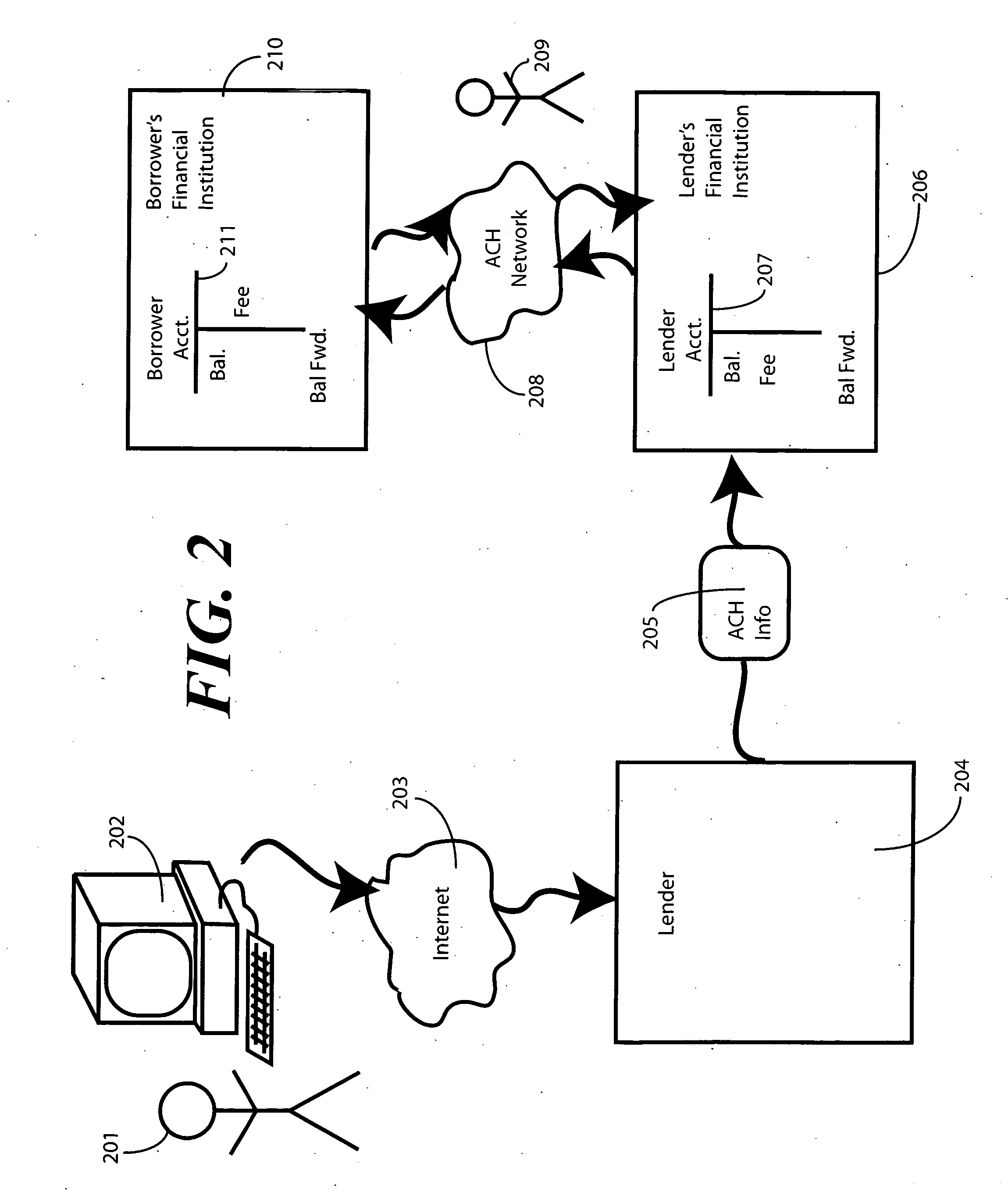

System for inexpensively executing online purchases

InactiveUS7092913B2Speeds the execution of online transactionsFinanceMultiple digital computer combinationsThird partyBank account

The present invention is a system for making online purchases using electronic funds transfers from the buyers' bank account to the vendor's bank account, enabled by an intermediate funds transfer from the buyer's account to a holding account maintained by the buyer's bank or a third party. The system is further enabled by the buyer's bank acting as a portal to the Internet that pre-authenticates buyers, enforces security, and speeds the execution of online transactions.

Owner:CANNON JR THOMAS CALVIN

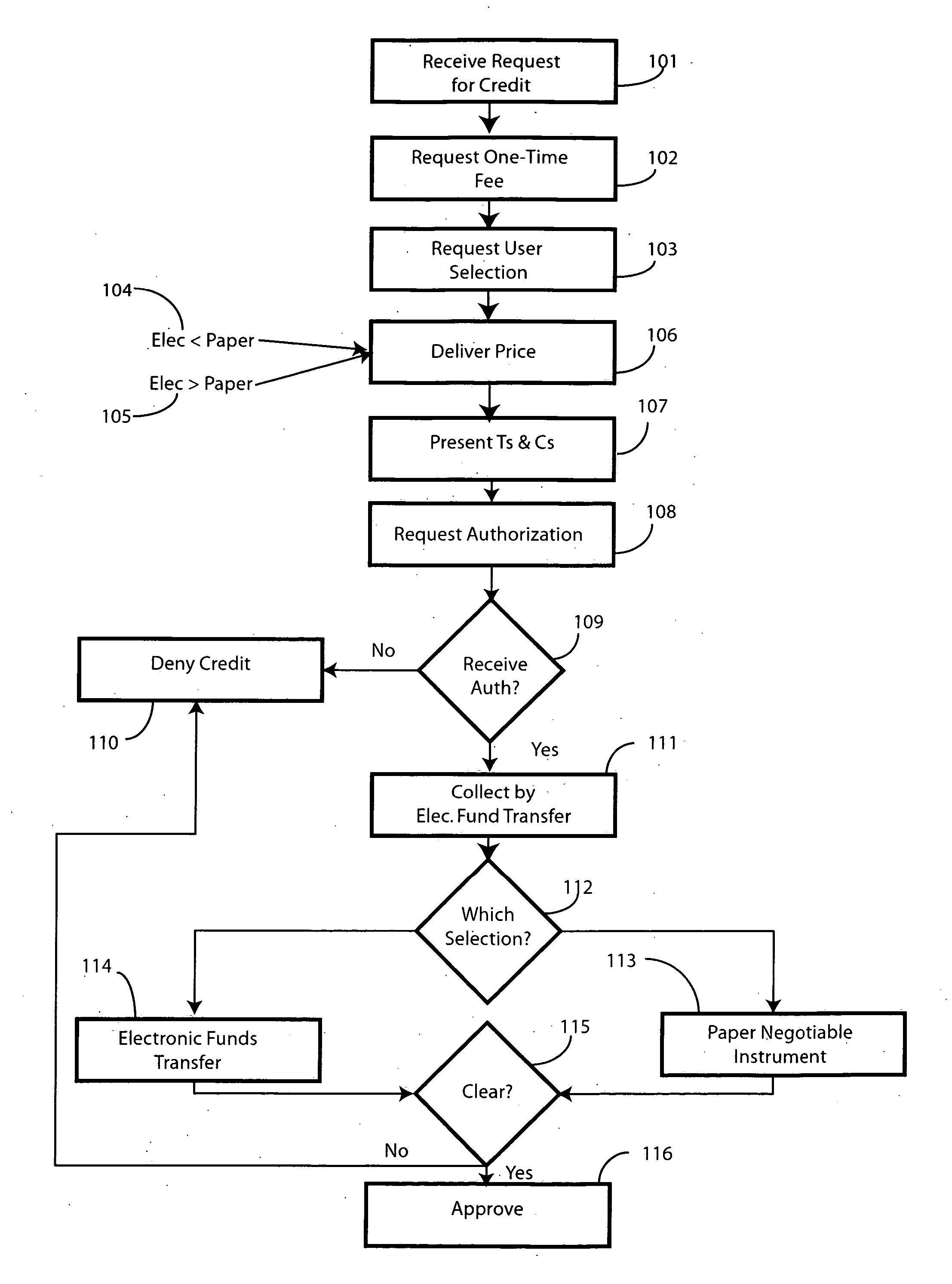

Method and system for account verification

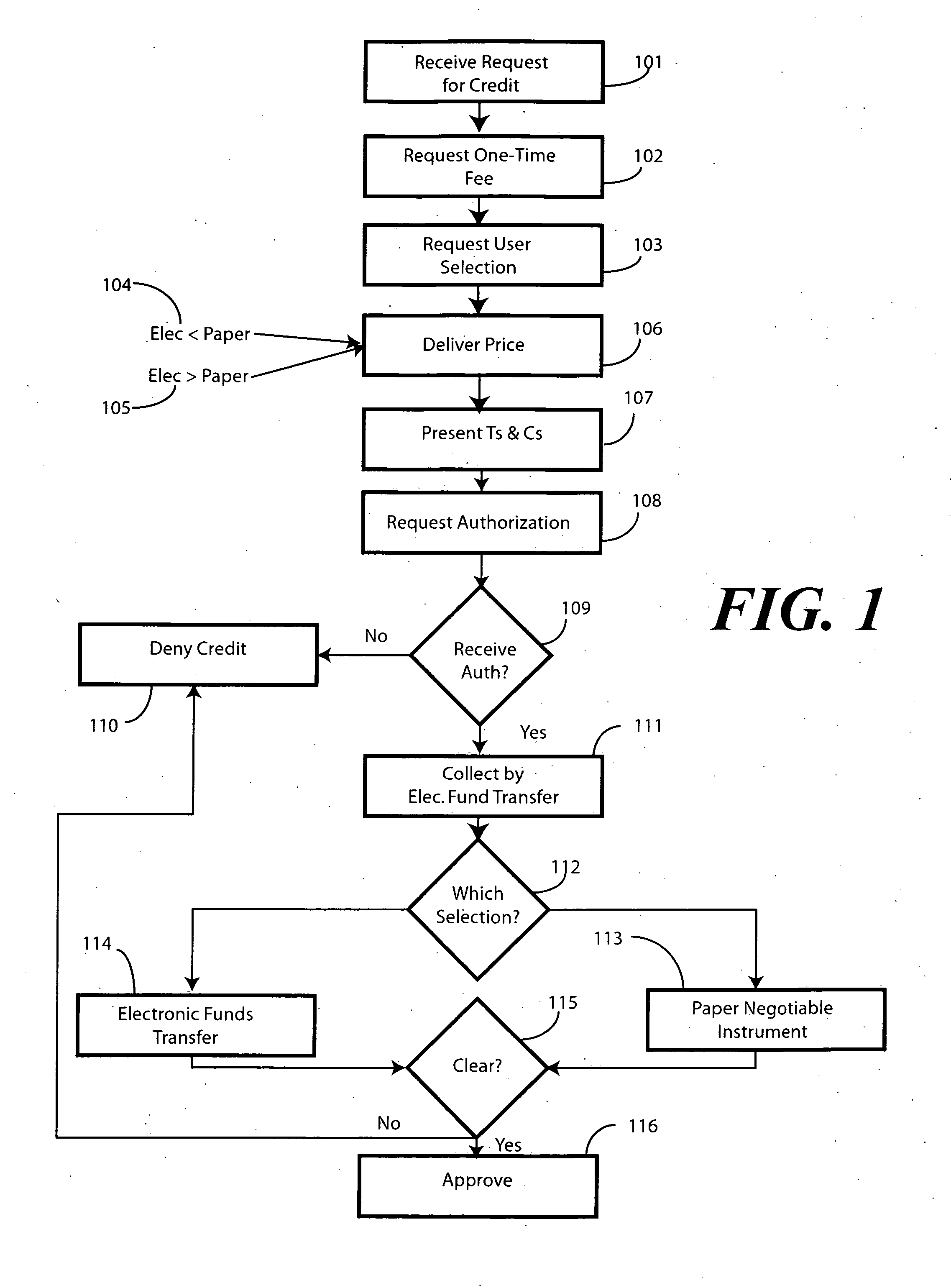

A system and method for verifying the existence of a deposit account, such as a checking account, are provided. The system and method may also be used to determine whether the deposit account is configured to receive automatic transactions for withdrawal. For example, a lender may extend an offer of credit to a borrower where payments of principal and interest are to be made by automatic withdrawals. Prior to transferring the principal, the lender verifies the existence and configuration of the borrower's deposit account by charging a fee to establish the line of credit and retrieving the fee by automatic withdrawal. Once the transaction clears and the lender receives the fee, the lender is assured that the account does exist and is configured to receive automatic transactions. Two exemplary methods of retrieving the fee are electronic funds transfer and remote creation of a paper negotiable instrument.

Owner:CC SERVE

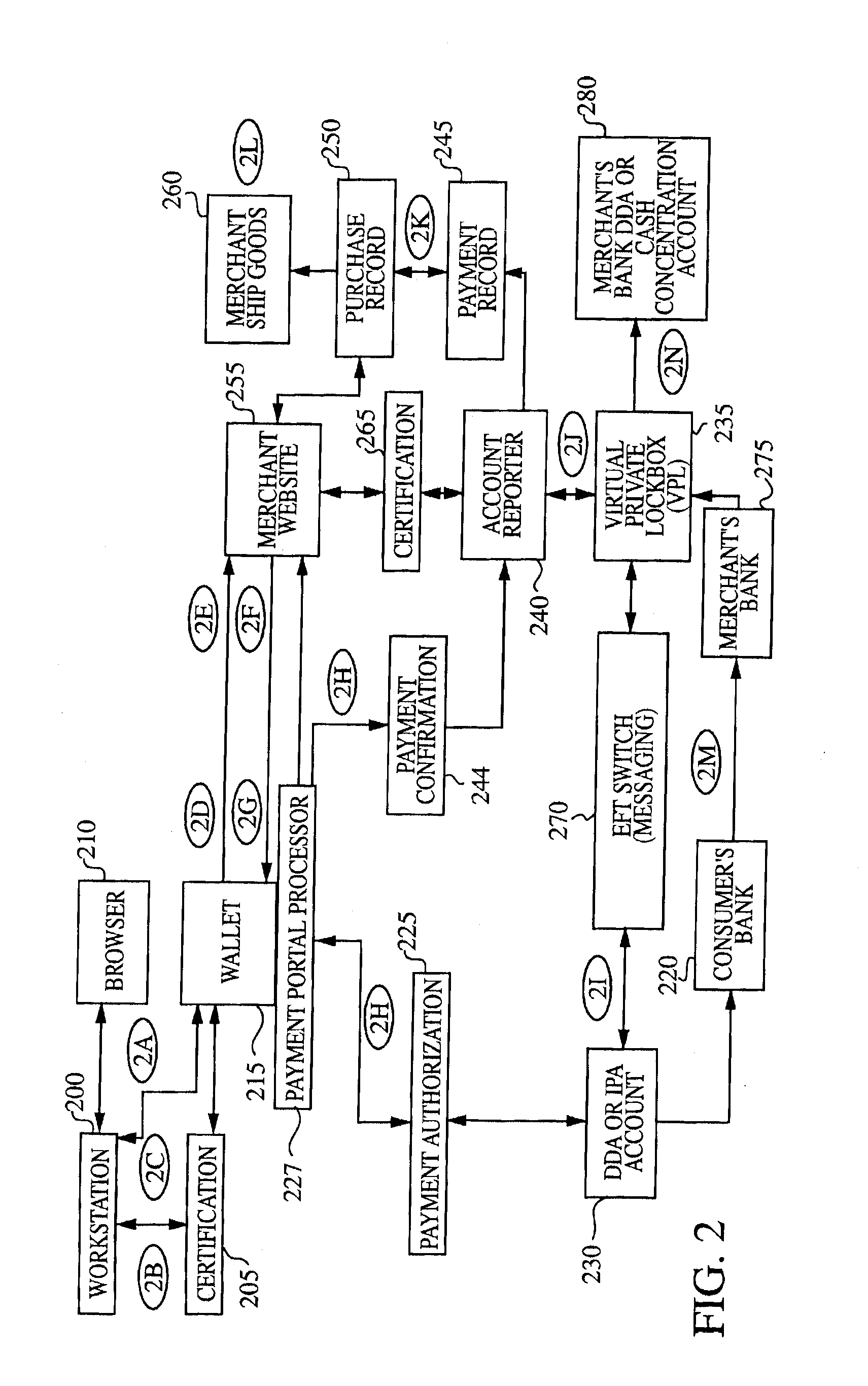

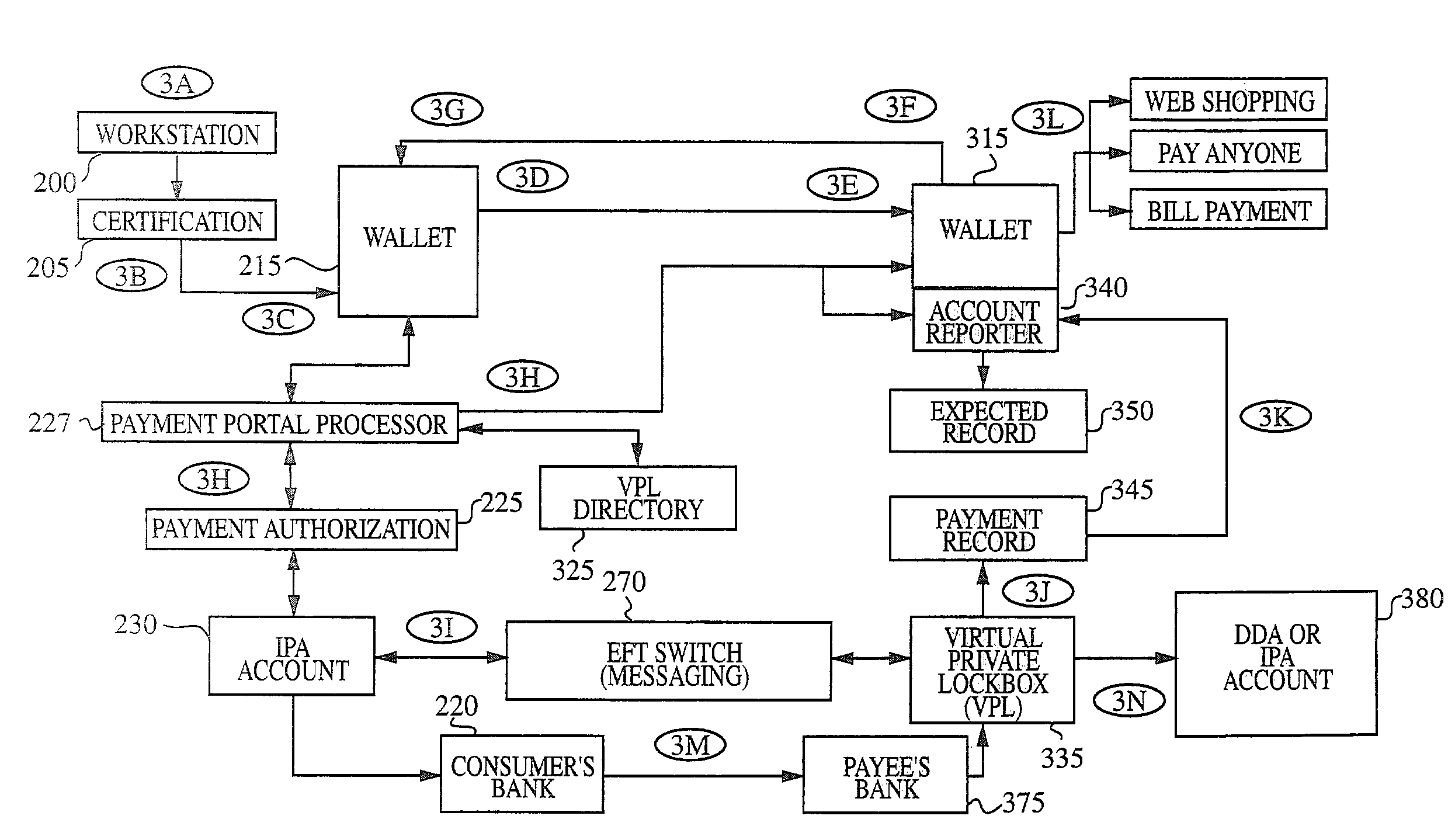

Method and system for processing internet payments using the electronic funds transfer network

InactiveUS7676431B2Safe, sound, and secureComplete banking machinesCredit registering devices actuationThe InternetAuthorization

Embodiments of the invention include a method and system for effectuating an electronic payment between a payor and a payee using an Electronic Funds Transfer (EFT) network. The method is implemented by a system having multiple processors. The payor may hold a payor account at a payor institution and the payee may have a payee account at a payee institution. The method includes generating a payment authorization identifying the payee institution, the payee account, and an amount of the payment and transmitting the payment authorization to the payor institution. The method further includes debiting the payor account by the amount of the payment; transmitting from the payor institution to the payee institution though the EFT network an EFT credit message representing a credit in the amount of the payment; and crediting the payee account in the amount of the payment in response to the receipt of the EFT credit message.

Owner:JPMORGAN CHASE BANK NA

Credit underwriting based on paper instrument

A credit underwriting technique that allows a consumer to gain early access to funds for paying bills or conducting financial transactions contingent upon the consumer having a high-degree of reliability on the reception of future funds, and / or the granting of access to at least a portion of the funds represented by the future funds when received. The access can be in the form of a paper check that is issued from an account in which the paycheck is deposited, an electronic fund transfer from the same account, or a direct deposit of the paycheck into either a lender accessible account or into the lenders account directly. The access can be applied for aggregated financial transactions or can be periodically applied for recurring transactions.

Owner:COMPUCREDIT INTPROP HLDG CORP II

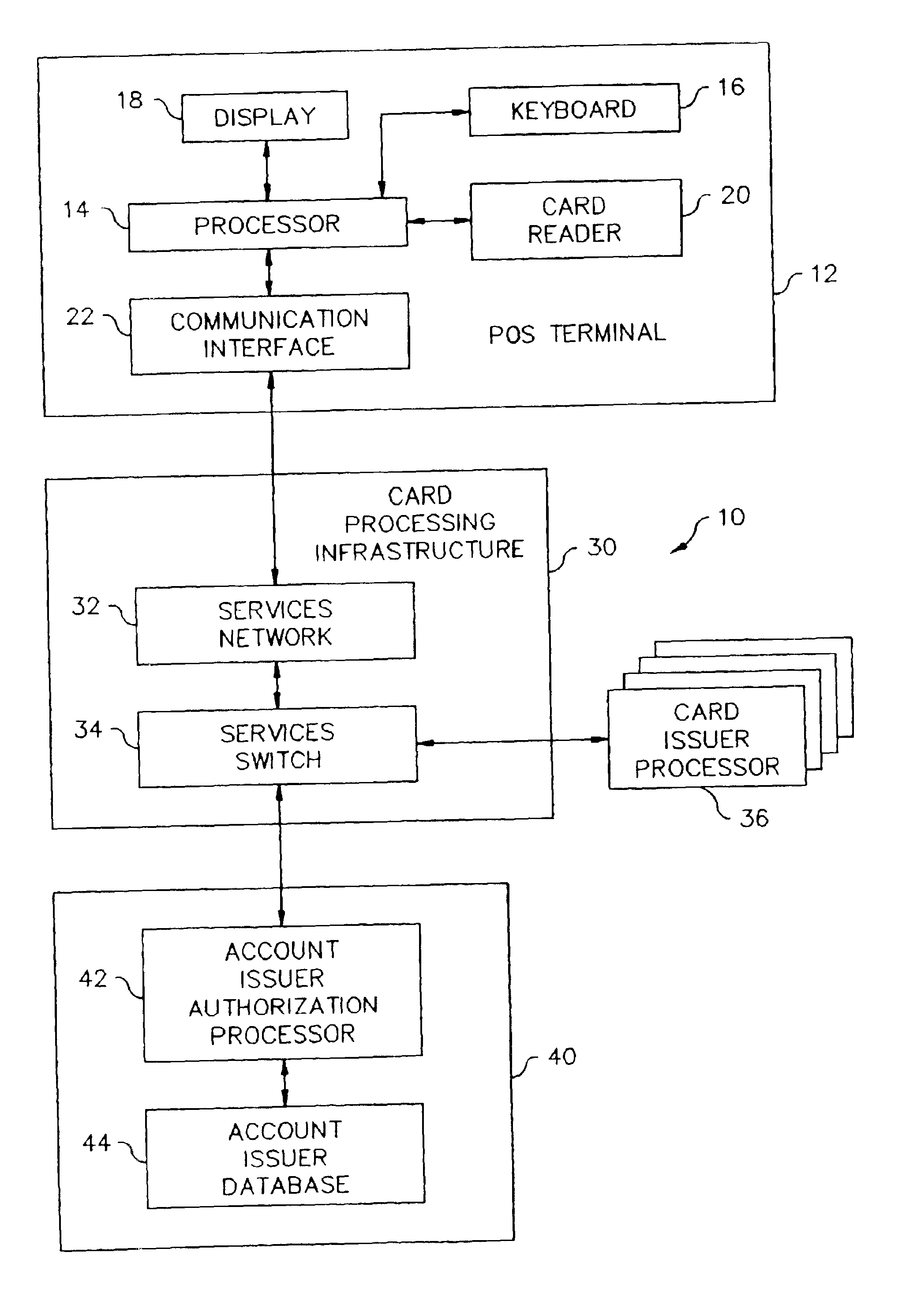

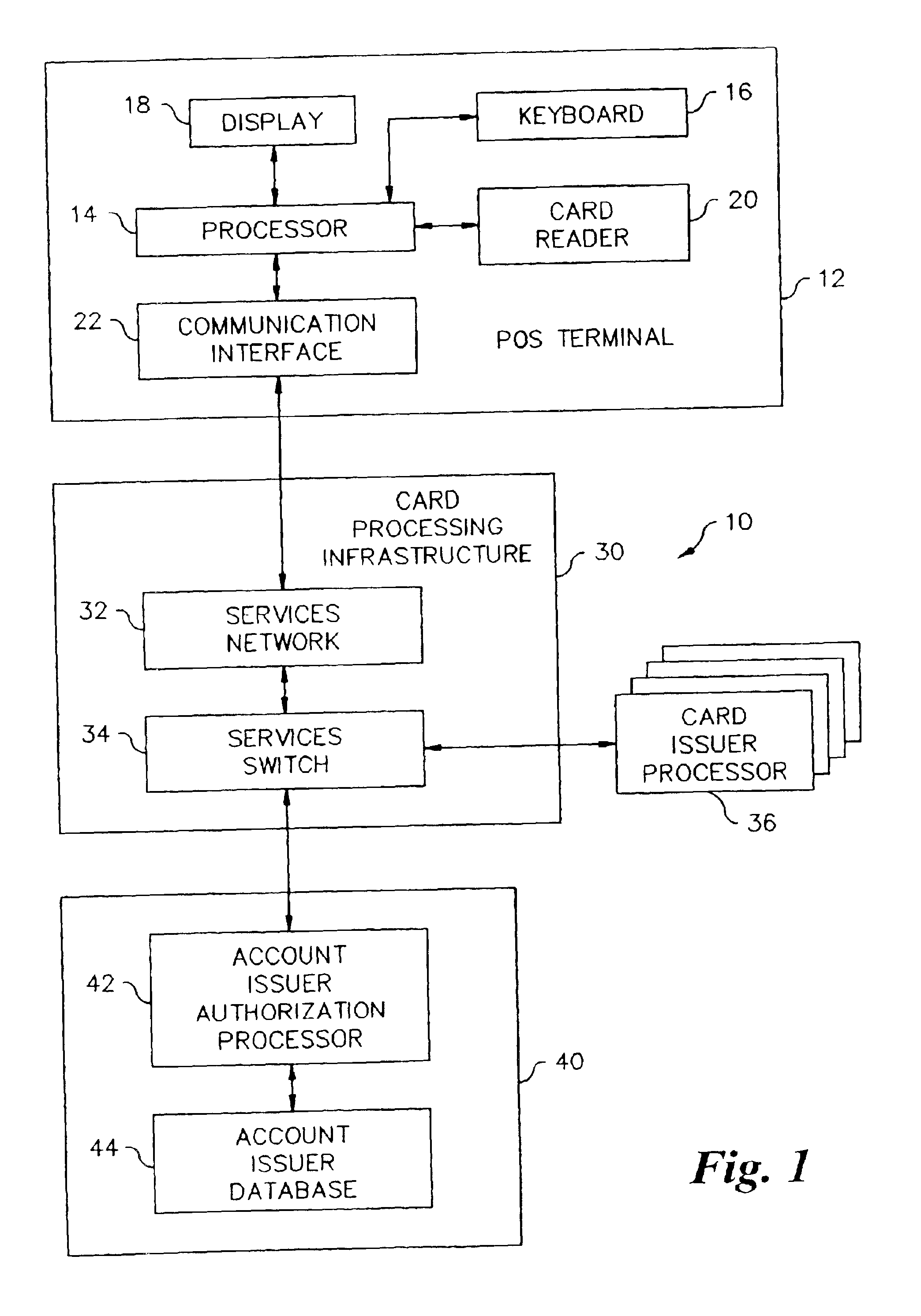

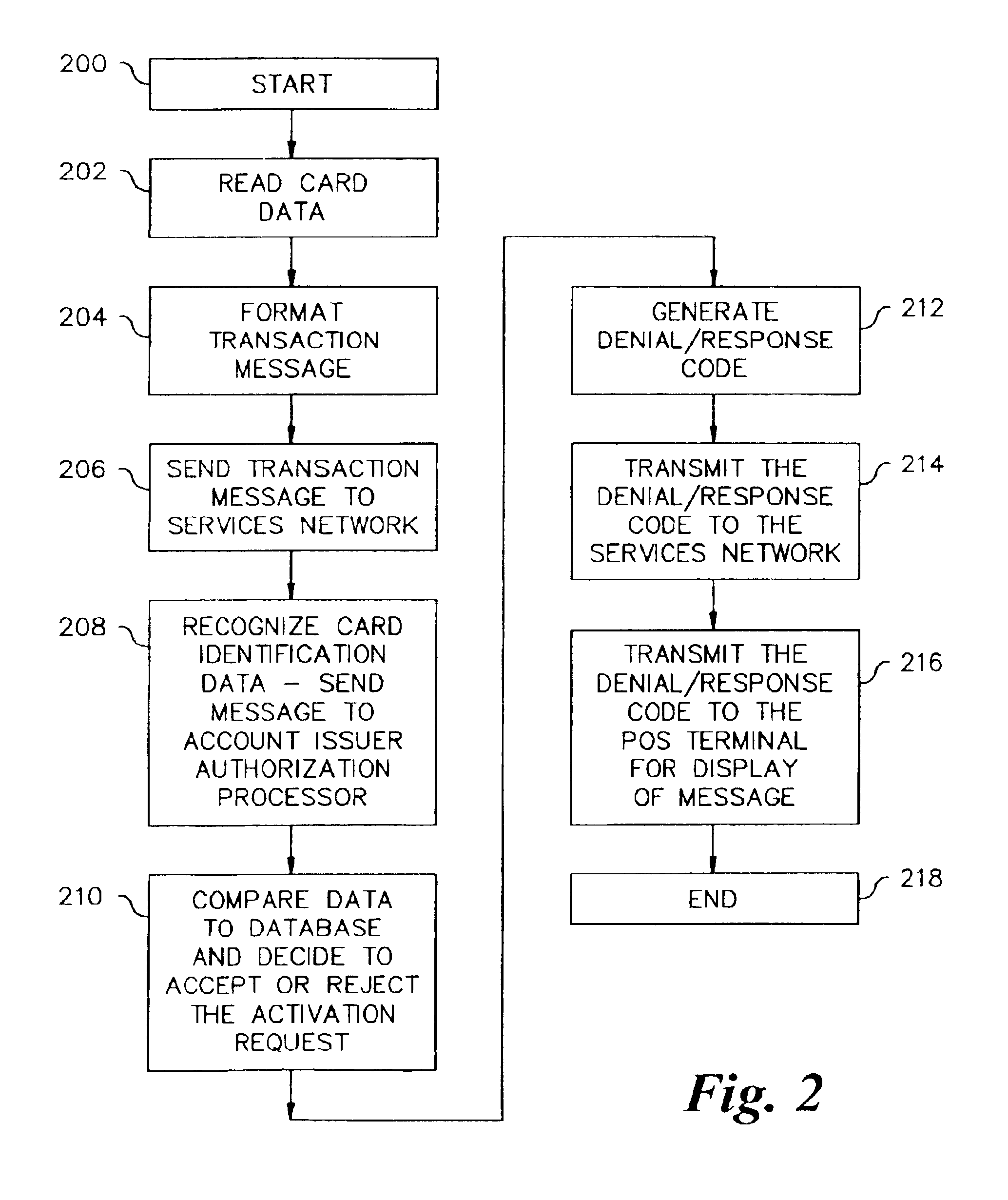

Method and system for account activation

A method of activating a prepaid account uses an existing electronic funds transfer network which includes a point-of-sale (POS) terminal, debit / credit card processing infrastructure and an account issuer authorization center. The method includes obtaining identification data concerning the account to be activated at the POS terminal; sending an activation request from the POS terminal through the card processing infrastructure to the processing center; receiving the activation request message at the processing center, deciding whether or not to activate the account and generating a response code based upon the activation decision, the response code not resulting in the transfer of any funds and being a code other than an approval code or a denial code; sending the response code through the card processing infrastructure to the POS terminal; and receiving the response code at the POS terminal and confirming at the POS terminal that the account has been activated.

Owner:THE WESTERN UNION CO +1

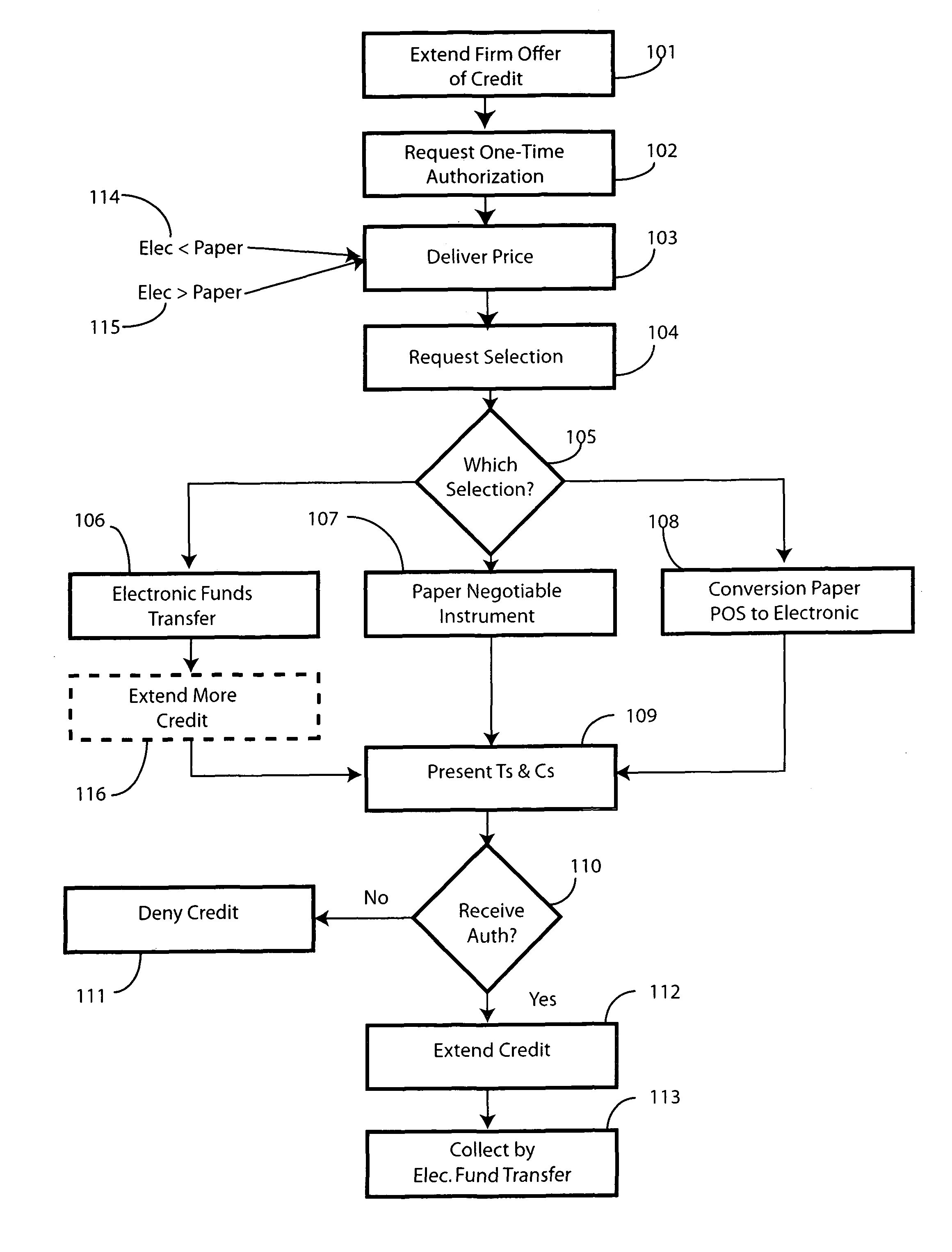

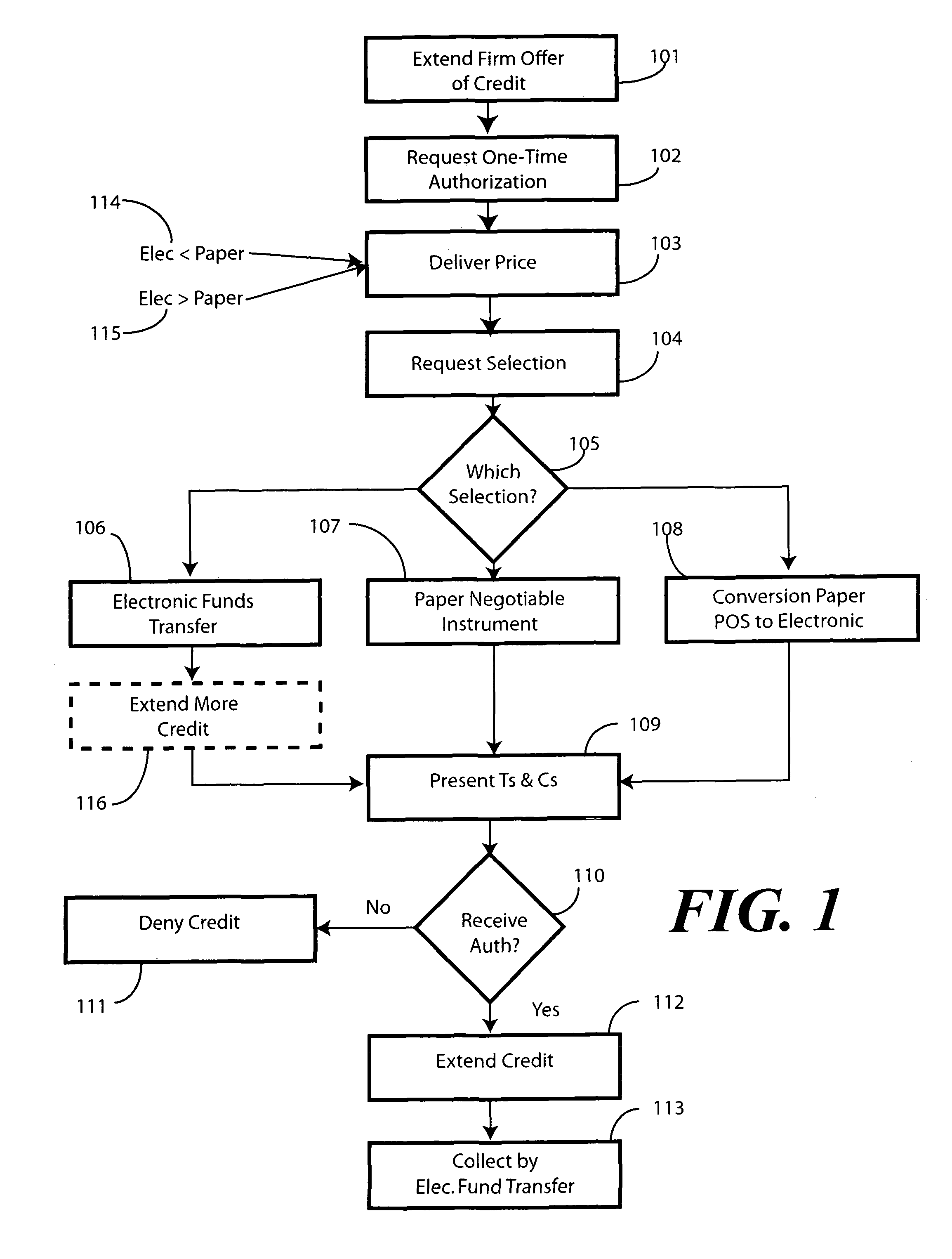

Method and system for extending credit with automated repayment

A system and method for extending a firm offer of credit contingent upon receiving a one-time authorization to execute recurring automatic withdrawals from a deposit account is provided. In providing the one-time authorization to execute recurring automatic withdrawals, a prospective borrower may elect from a plurality of automatic withdrawal repayment options. One such option is electronic fund transfer, such as the initiation of a withdrawal entry into the Automated Clearing House network. A second option is by the remote creation of a paper negotiable instrument, which is then converted into an electronic substitute check capable of electronic routing. Upon receiving the one-time authorization, the lender may make recurring automatic withdrawals from the borrower's deposit account.

Owner:CC SERVE

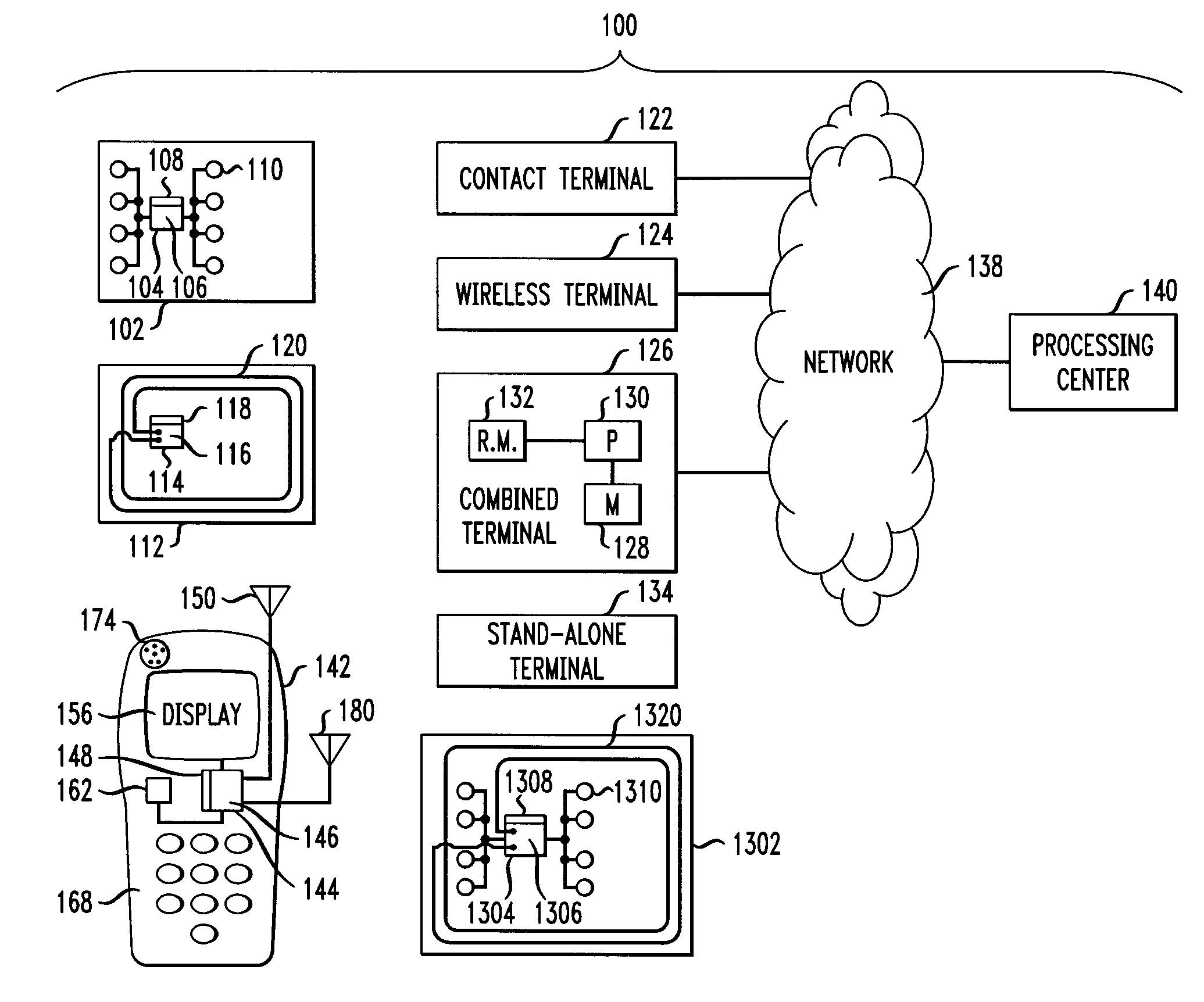

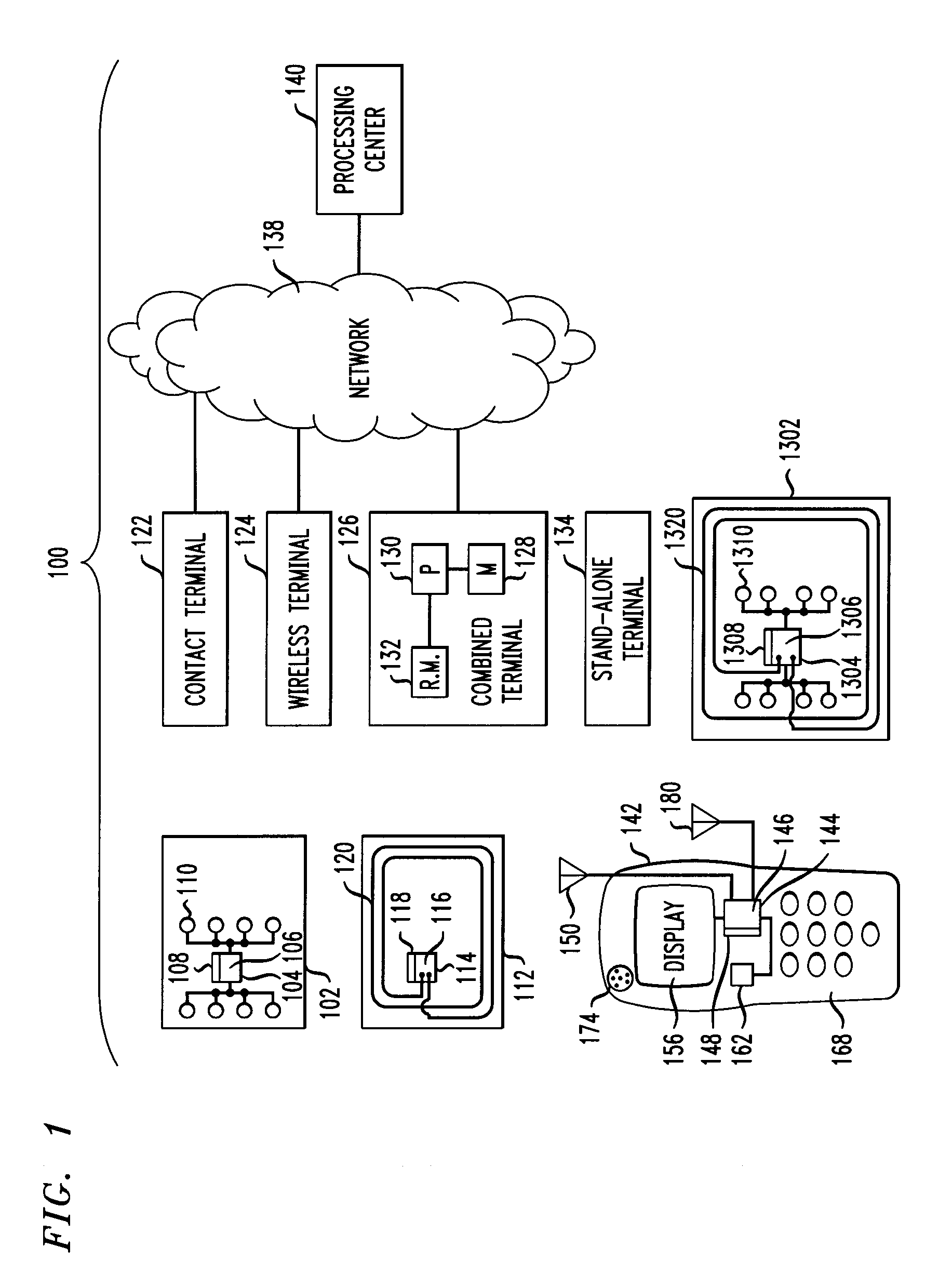

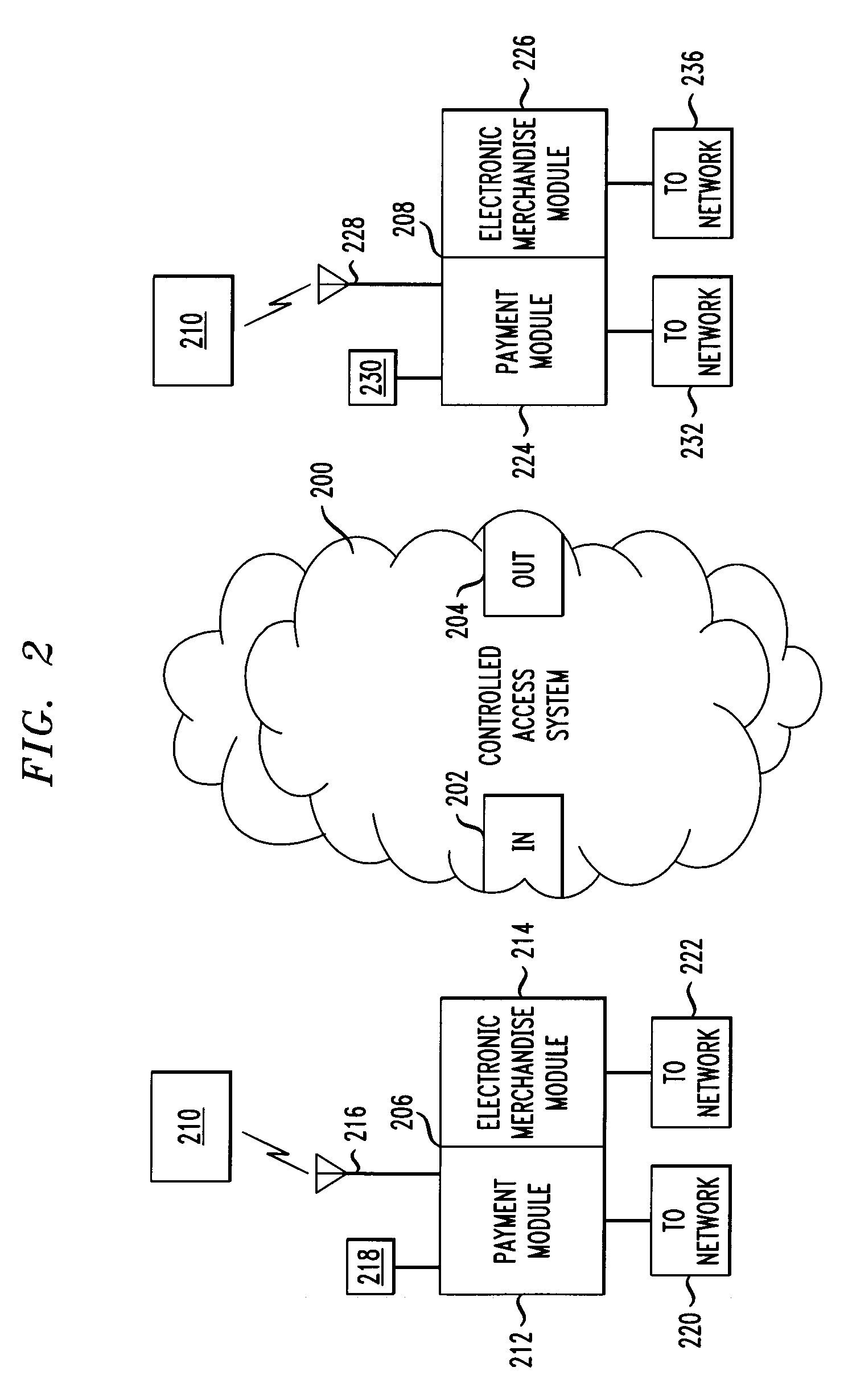

Apparatus and method for integrated payment and electronic merchandise transfer

ActiveUS20100252624A1Efficient combinationEasy transferTransportation facility accessFinanceRelevant informationSummary data

Interrogation of an electronic device by a first terminal is facilitated, to obtain an account number associated with the electronic device. The electronic device is configured according to a payment specification. The first terminal has a first terminal payment module configured according to the payment specification and a first terminal electronic merchandise module configured according to the electronic merchandise infrastructure and coupled to the first terminal payment module to permit transfer of non-payment e-merchandise related information from the first terminal electronic merchandise module to the first terminal payment module. The interrogation of the electronic device is performed by the first terminal payment module. Generation of non-payment e-merchandise related information by the first terminal electronic merchandise module is facilitated. Transfer of the non-payment e-merchandise related information from the first terminal electronic merchandise module to the electronic device via the first terminal payment module, within a transaction between the electronic device and the first terminal payment module that is conducted in accordance with the payment specification, is also facilitated. The non-payment e-merchandise related information is stored on the electronic device in accordance with the payment specification. The electronic device and the first terminal independently calculate a summary data item. The first terminal calculates a first message authentication code based on the non-payment e-merchandise related information and a terminal-calculated value of the summary data item. The non-payment e-merchandise related information is stored on the electronic device together with an electronic device-calculated value of the summary data item and the first message authentication code.

Owner:MASTERCARD INT INC

Biometric multi-purpose terminal, payroll and work management system and related methods

InactiveUS7229013B2Efficient use ofAssist in managementRegistering/indicating time of eventsFinanceFinancial transactionWork quality

Employees gain access to a payroll and work management system by authentication at a multi-purpose terminal with a bankcard encoded with a unique account number and a personal identification number (PIN). The terminal may then be used to check-in and checkout of work, to receive new work instructions or assignments, to review payroll details, to print a payroll stub, to execute financial transactions, to print a receipt of financial transactions or to review or to upload the results of work quality audits. The invention also includes systems and methods that utilize such multi-purpose terminals to calculate the payroll and deductions for each employee and to issue electronic fund transfers from the employer's bank account to deposit the net pay in a bank account associated with each employee's bankcard so that the pay is immediately accessible by each employee, such as by withdrawal of cash at an ATM or by purchases at a point of sale. Electronic payrolls may be processed and employee's accounts credited with pay on a daily basis, or on any preset period of time, including hourly.

Owner:AMERICAN EPS

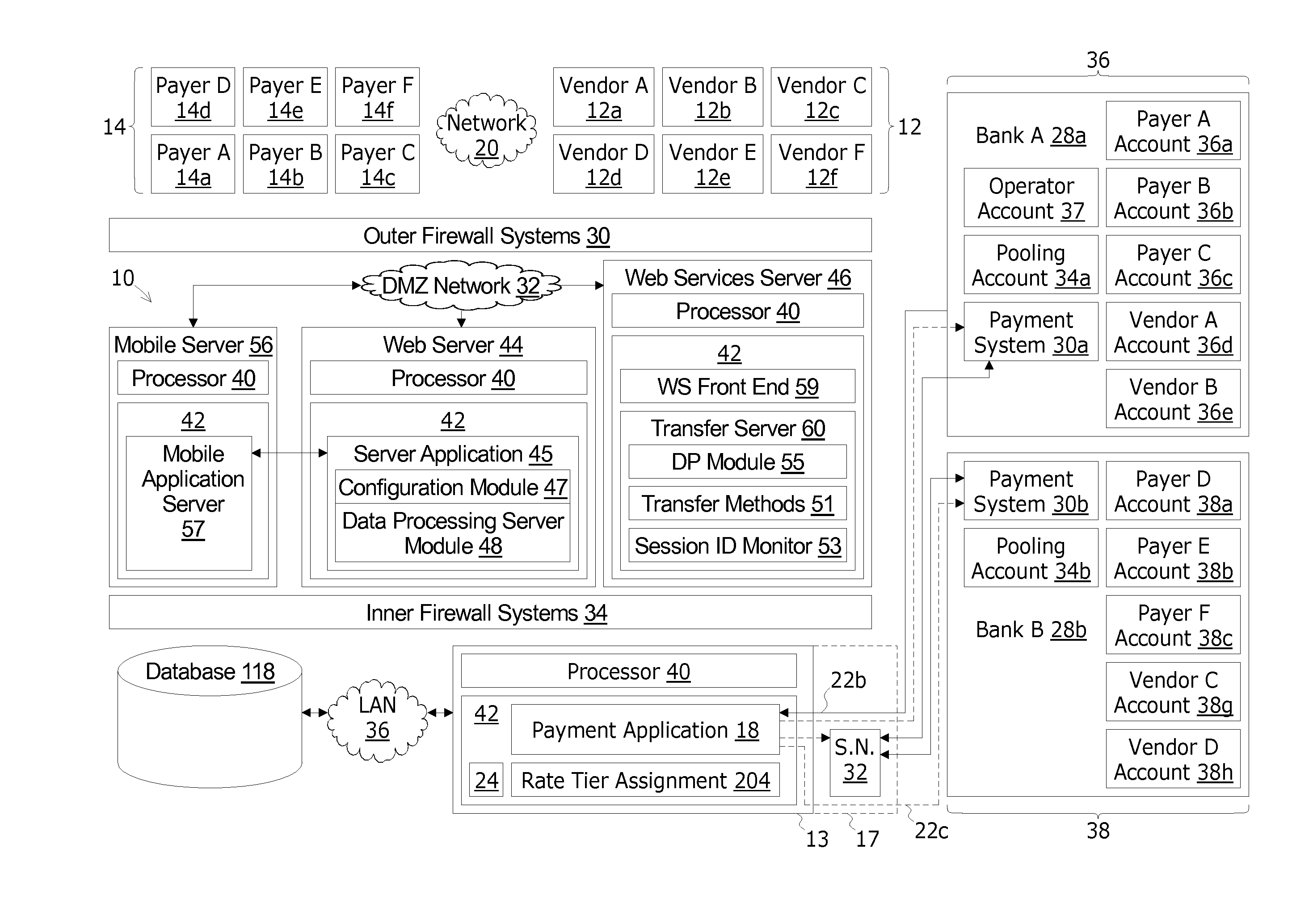

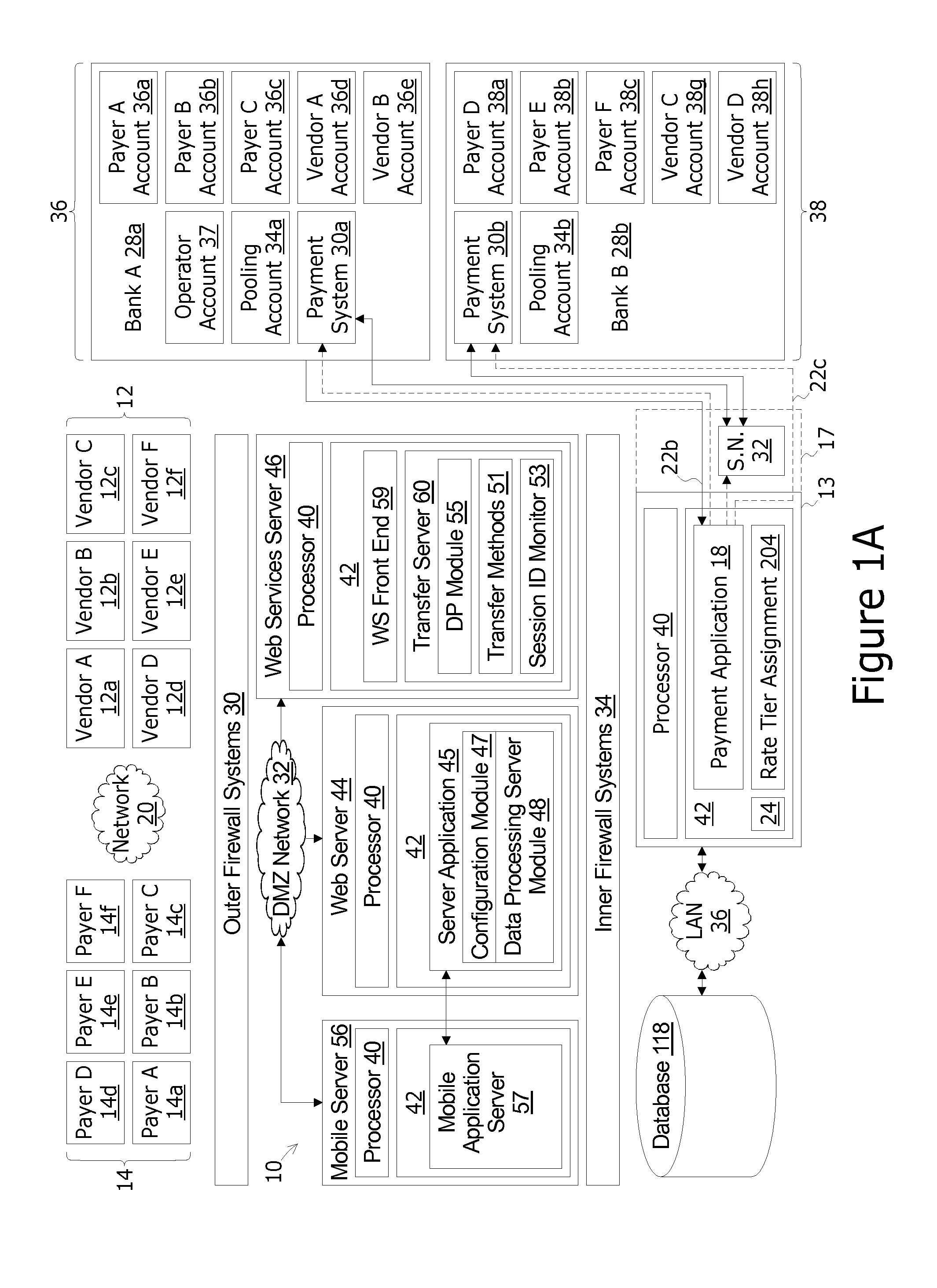

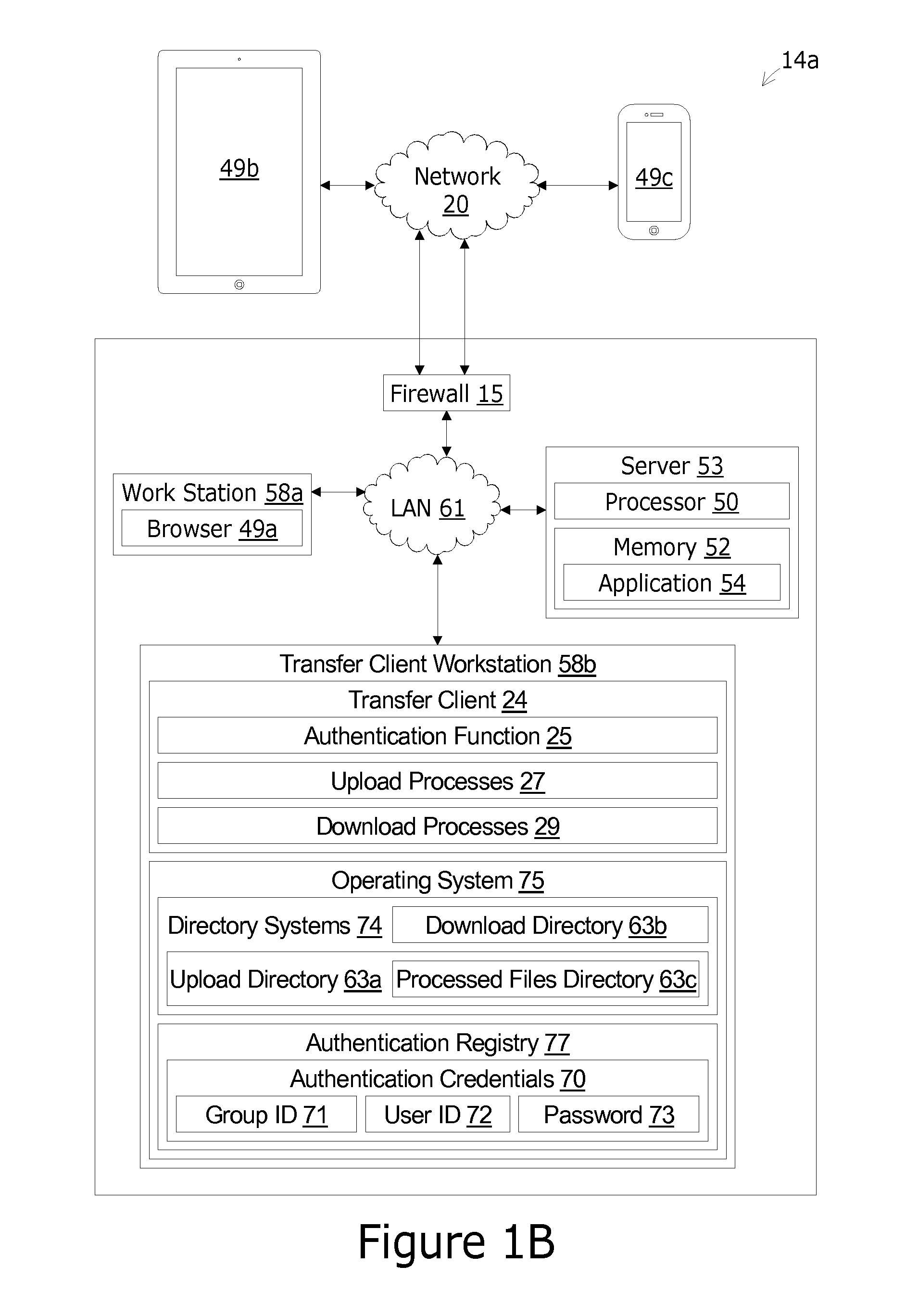

Integrated Payment System

A payment system executes payments from payers to vendors. An unattended interface system automates the uploading of payments file from each payer to the system. A web services transfer server performs the unattended transfer. Steps of a payment server generating an electronic funds transfer file with a group of fund transfer records for each payment represented by a record of the payment file. After the electronic funds transfer file is complete, the steps further comprise transferring the electronic fund transfer file to an electronic payment network for execution. Remittance records are transferred to the vendor utilizing an unattended transfer executed by the web services transfer server.

Owner:BOTTOMLINE TECH

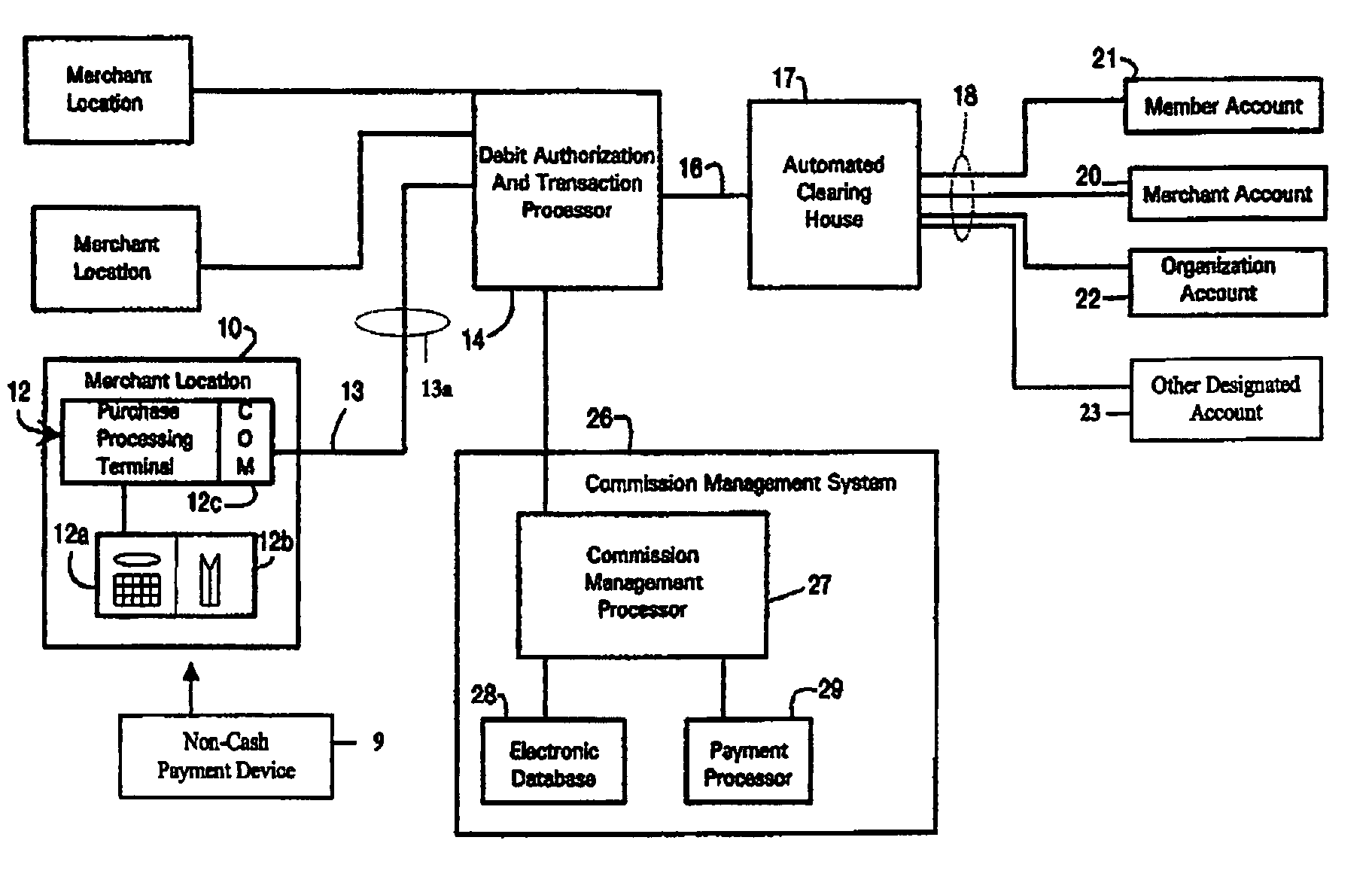

Non-cash transaction incentive and commission distribution system

An electronic fund transfer system is disclosed wherein commissions for point-of-sale purchase transactions are determined and distributed to members of an organizational network for promoting use of a non-cash payment device for effecting purchase transactions. Purchase data is electronically transmitted from the point-of-sale to an automated clearing house for effecting fund transfers to prepare the purchase, and also to a commission management system. The commission management system maintains an electronic database reflecting the structure of the organizational network, and further determines the distribution of purchase commissions according to a predetermined schedule of proportions relating to the position and business volume of each member of the network. The commission management system further comprises a payment processor for effecting commission payments to the members or to a designated sponsor on a scheduled basis.

Owner:MASI LARRY A

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com