Patents

Literature

2237 results about "Electronic signature" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

An electronic signature, or e-signature, refers to data in electronic form, which is logically associated with other data in electronic form and which is used by the signatory to sign. This type of signature provides the same legal standing as a handwritten signature as long as it adheres to the requirements of the specific regulation it was created under (e.g., eIDAS in the European Union, NIST-DSS in the USA or ZertES in Switzerland).

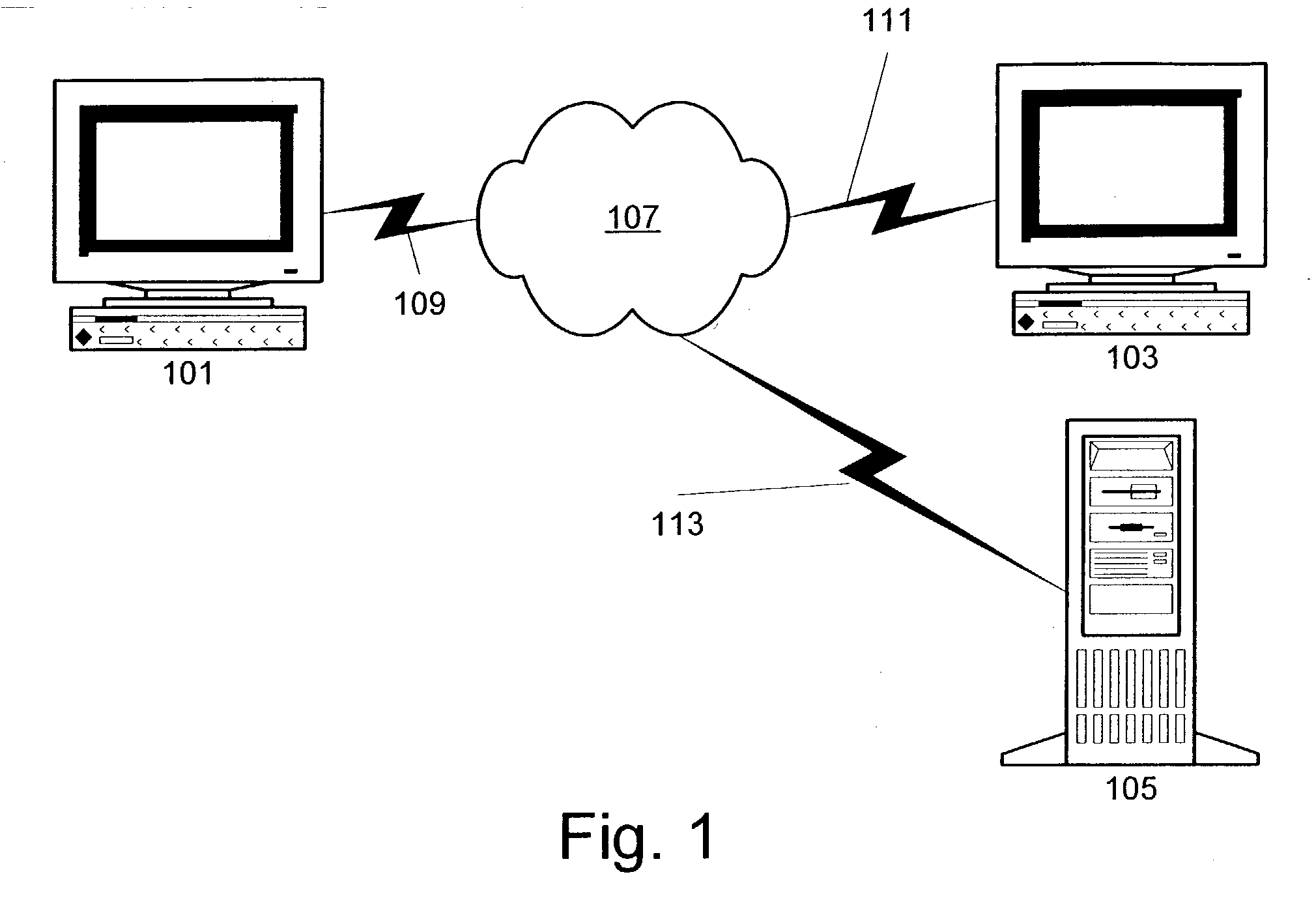

Systems and methods for electronically verifying and processing information

InactiveUS20030009418A1Reduce riskFacilitate a convenient, efficient and expeditious credit-risk evaluationFinanceLogisticsInternet privacyProcess information

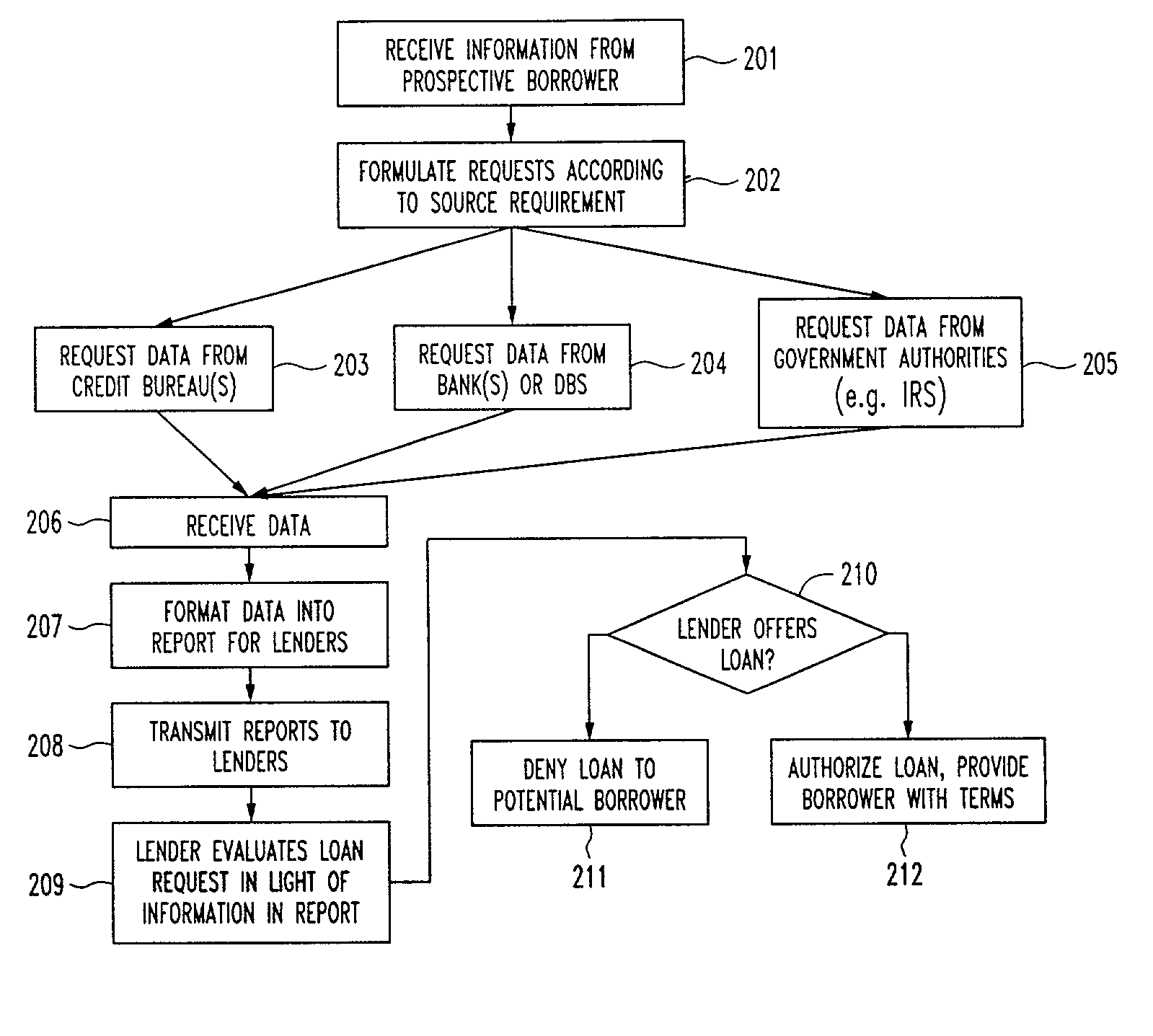

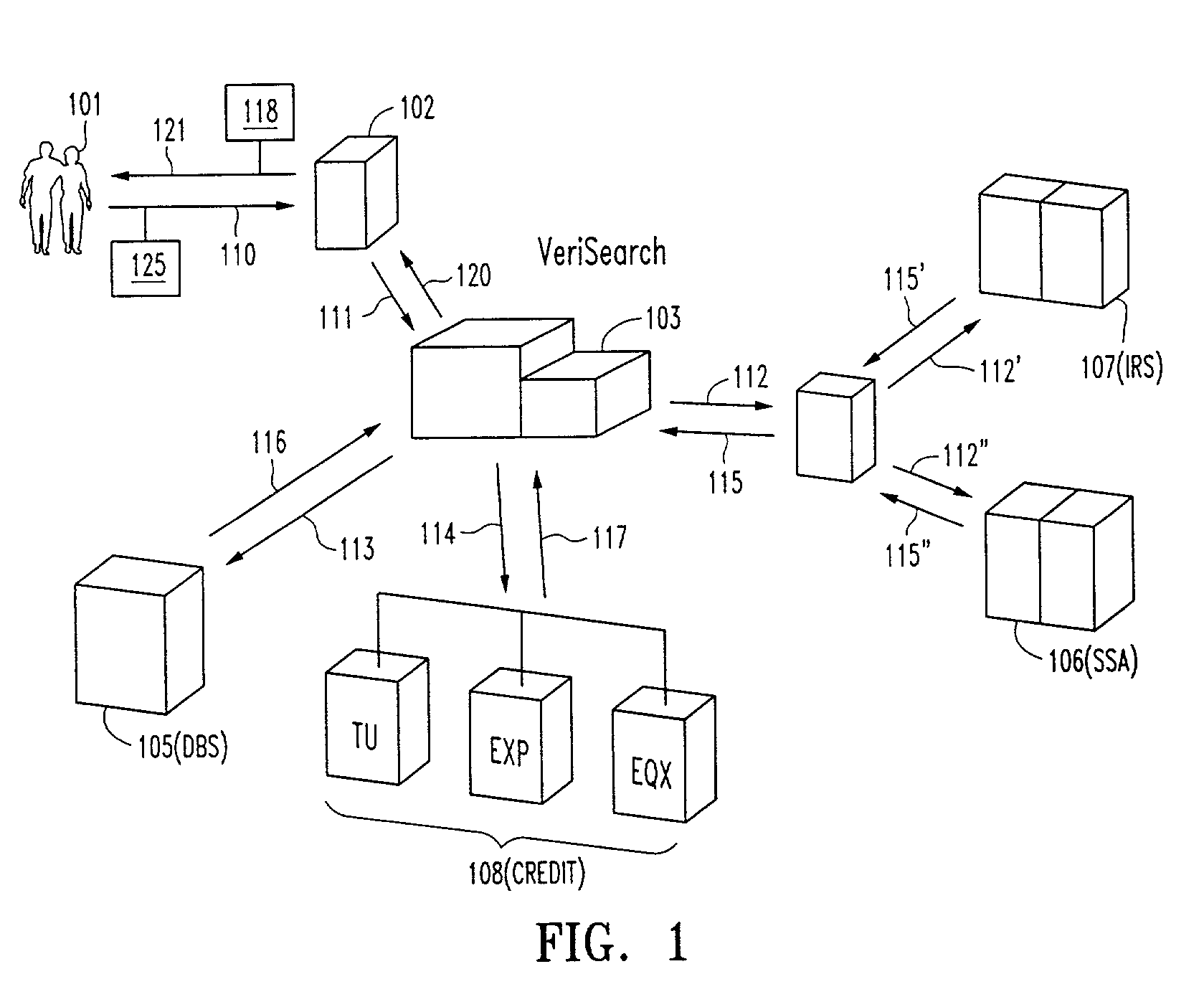

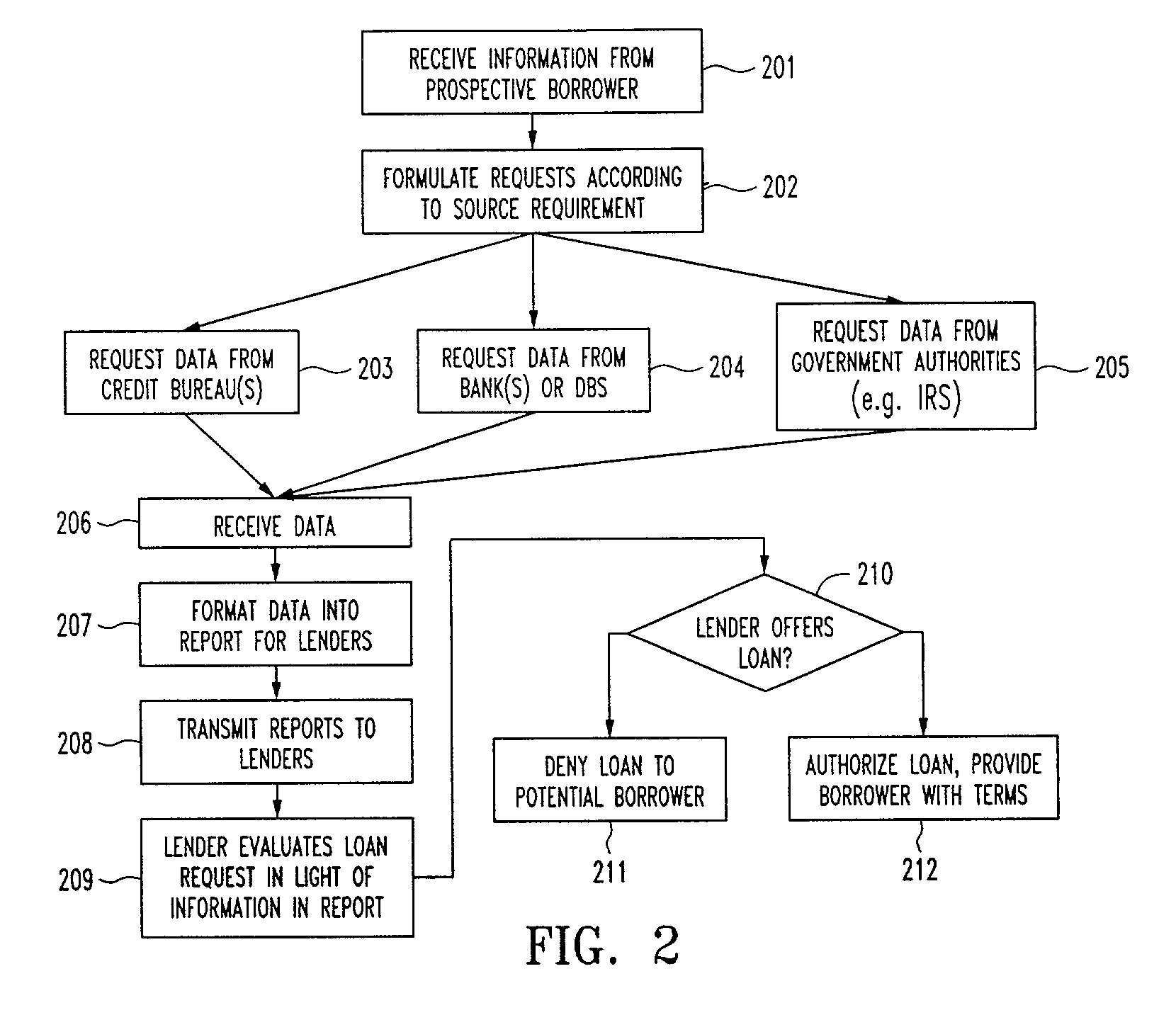

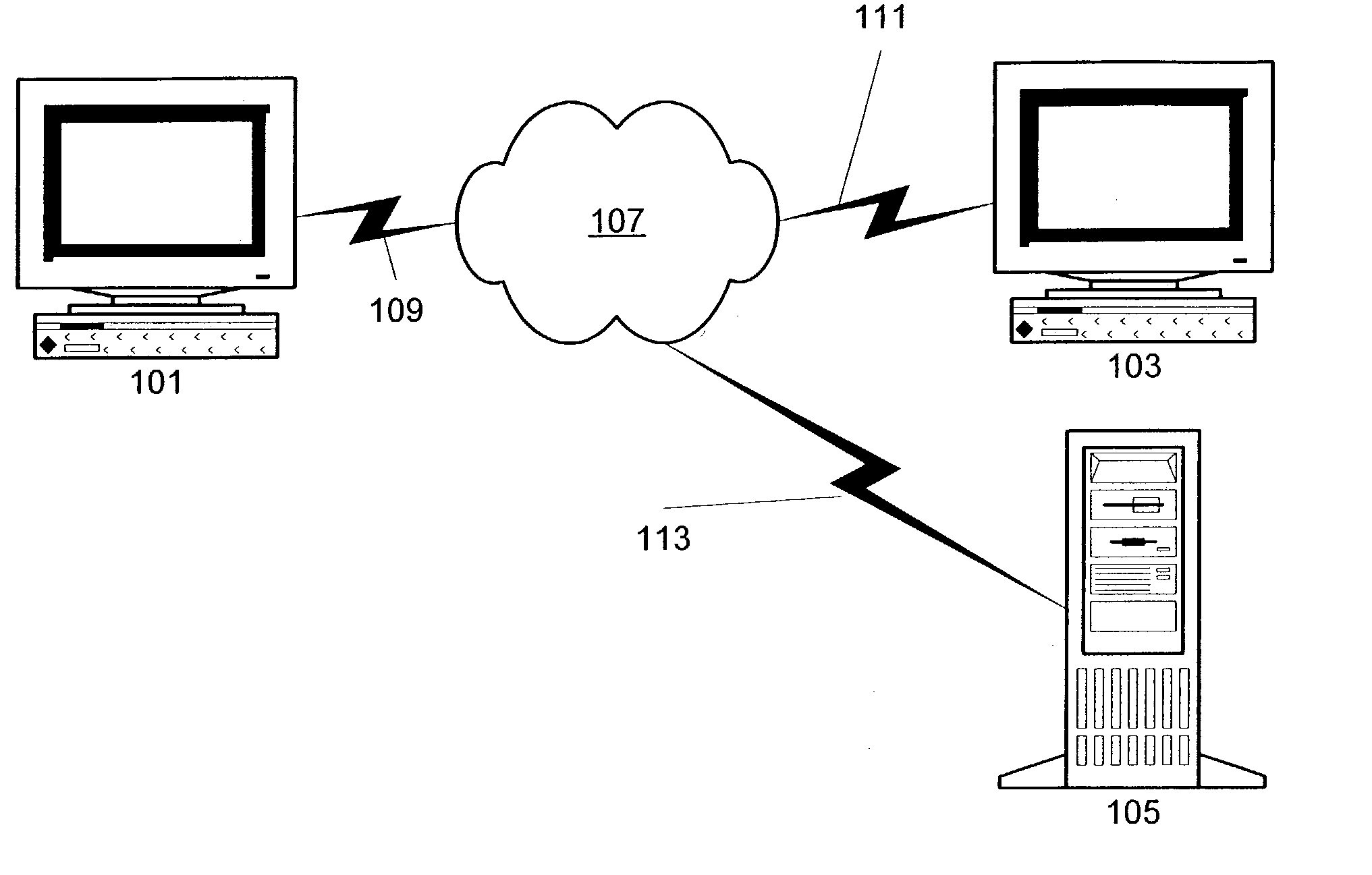

A computer implemented method and system which provides current, reliable and accurate personal information regarding a prospective borrower and / or co-borrower. The system includes a central server which receives requests for personal information relating to proposed borrowers, which in turn parses out similar requests relating to that borrower to information sources such as, among others, the Internal Revenue Service, the Social Security Administration, the Daily Banking System and the pertinent credit bureaus. Information corresponding to the respective requests is retrieved from the information sources, and then compiled into a report format and forwarded to the requested party. The requested party may be the borrower / consumer individually, or may be a mortgage broker / agent, lending institution or other party authorized to request and obtain the information. An electronic signature or signatures accompany the request to the central server, which uses same to retrieve personal information data pertaining to the signatory(ies). Various encryption schemes may be employed for security purposes. The invention permits for the retrieval, compilation and reporting of relevant, personal data to a party or parties involved in the loan decision making process without any opportunity for the information to be tampered with by the proposed borrower(s) because the information is obtained electronically and directly from the information depositories.

Owner:GREEN GERALD M +1

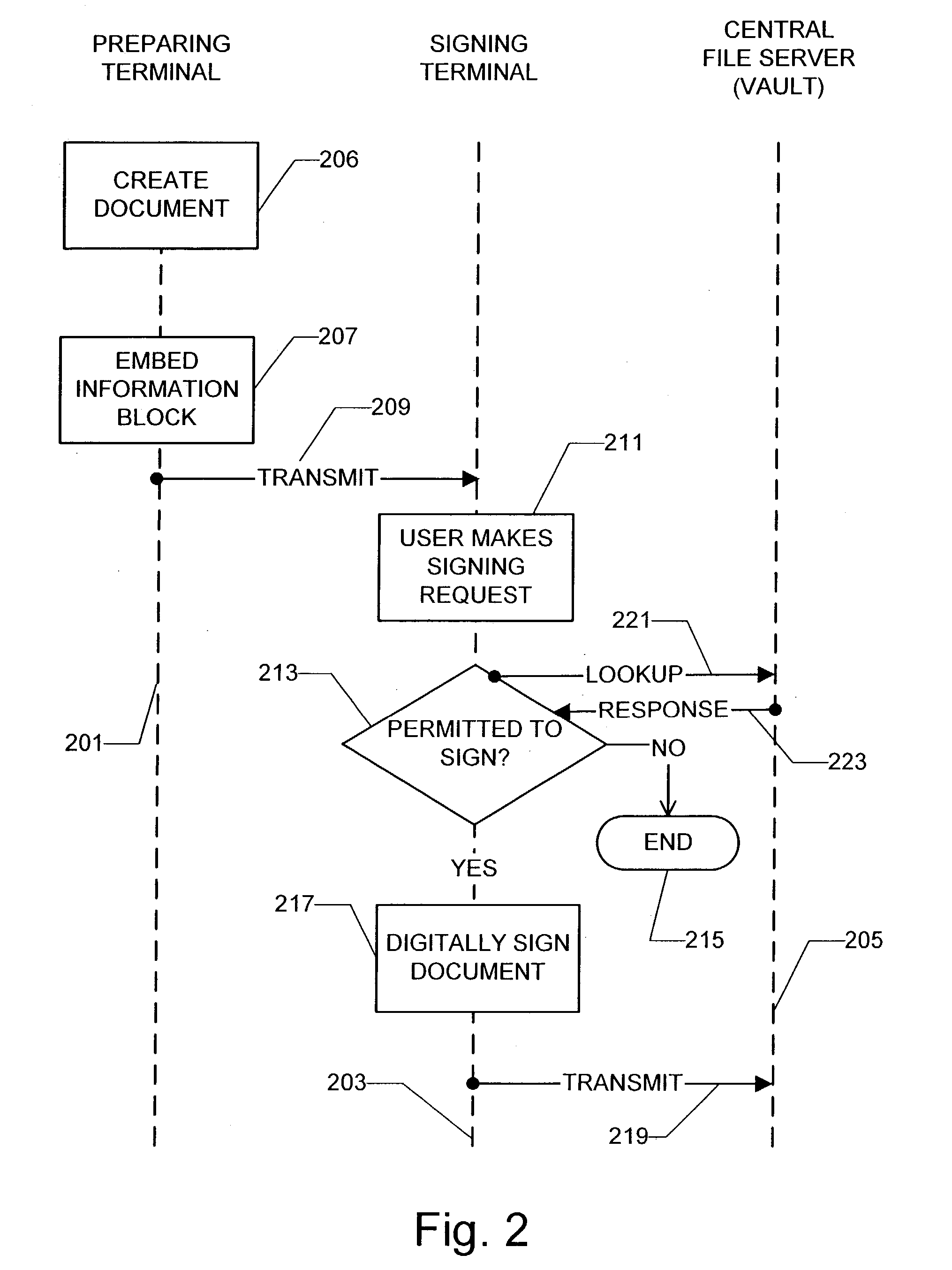

Method and system for electronically signing and processing digital documents

InactiveUS20030078880A1FinanceUser identity/authority verificationElectronic documentInternet privacy

A method and system for managing the electronic signing of digital documents is disclosed. An electronic document created and prepared for signing by associating certain signing constraints with the document. Indicia of the signing constraints are encoded into a document information block or blocks that are embedded into the document. The information block may include indicia of a database record at a central server that stores indicia of the signing constraints in addition to or in lieu of including the signing constraint indicia in the document information block or blocks. Upon receiving the prepared document at a signing terminal, the information blocks are extracted and the signing constraints tested. If the user desires to sign the document, and if the user is permitted to sign, the document is electronically signed and transmitted to the central file server for storage.

Owner:WAVE SYST

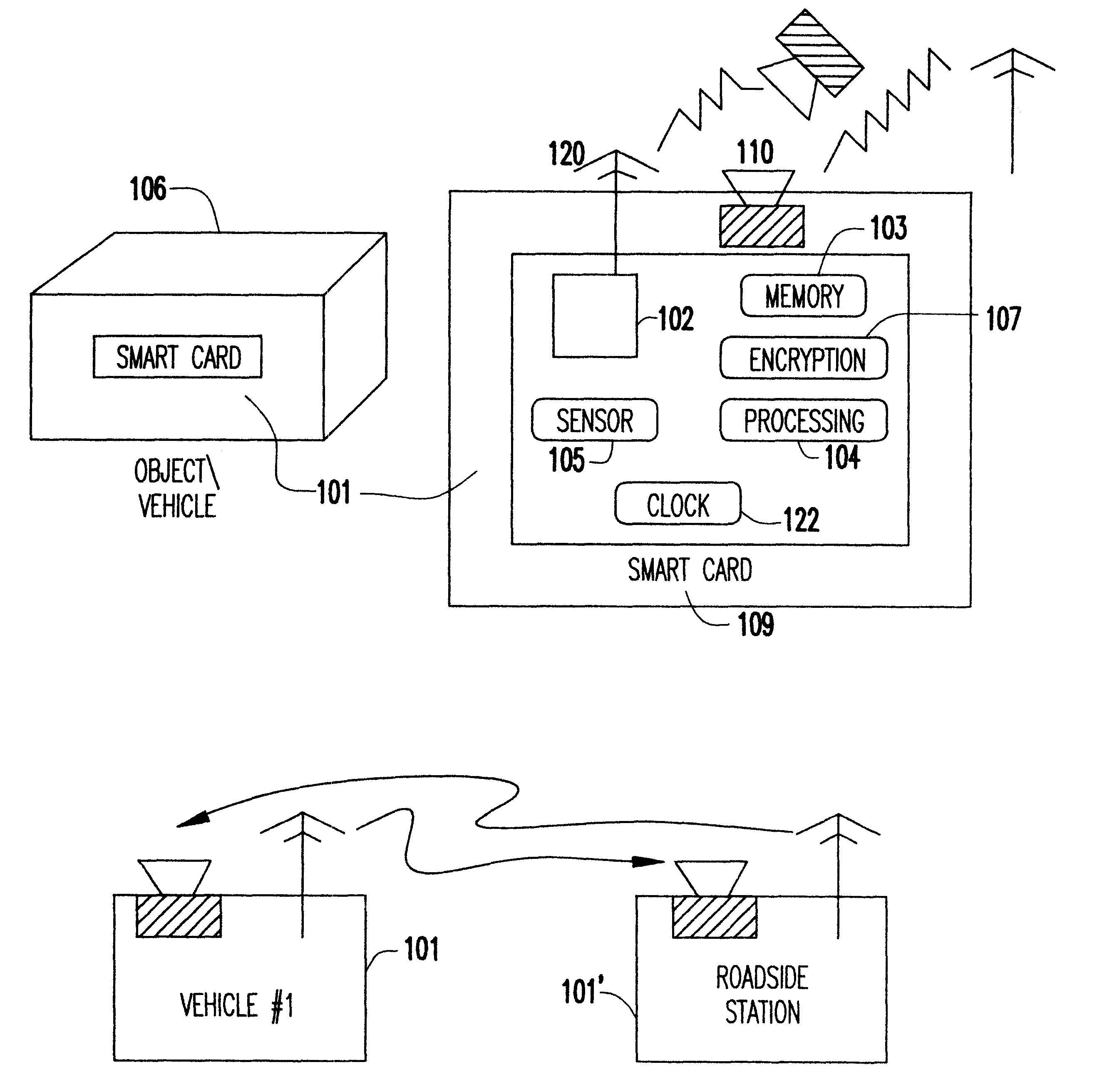

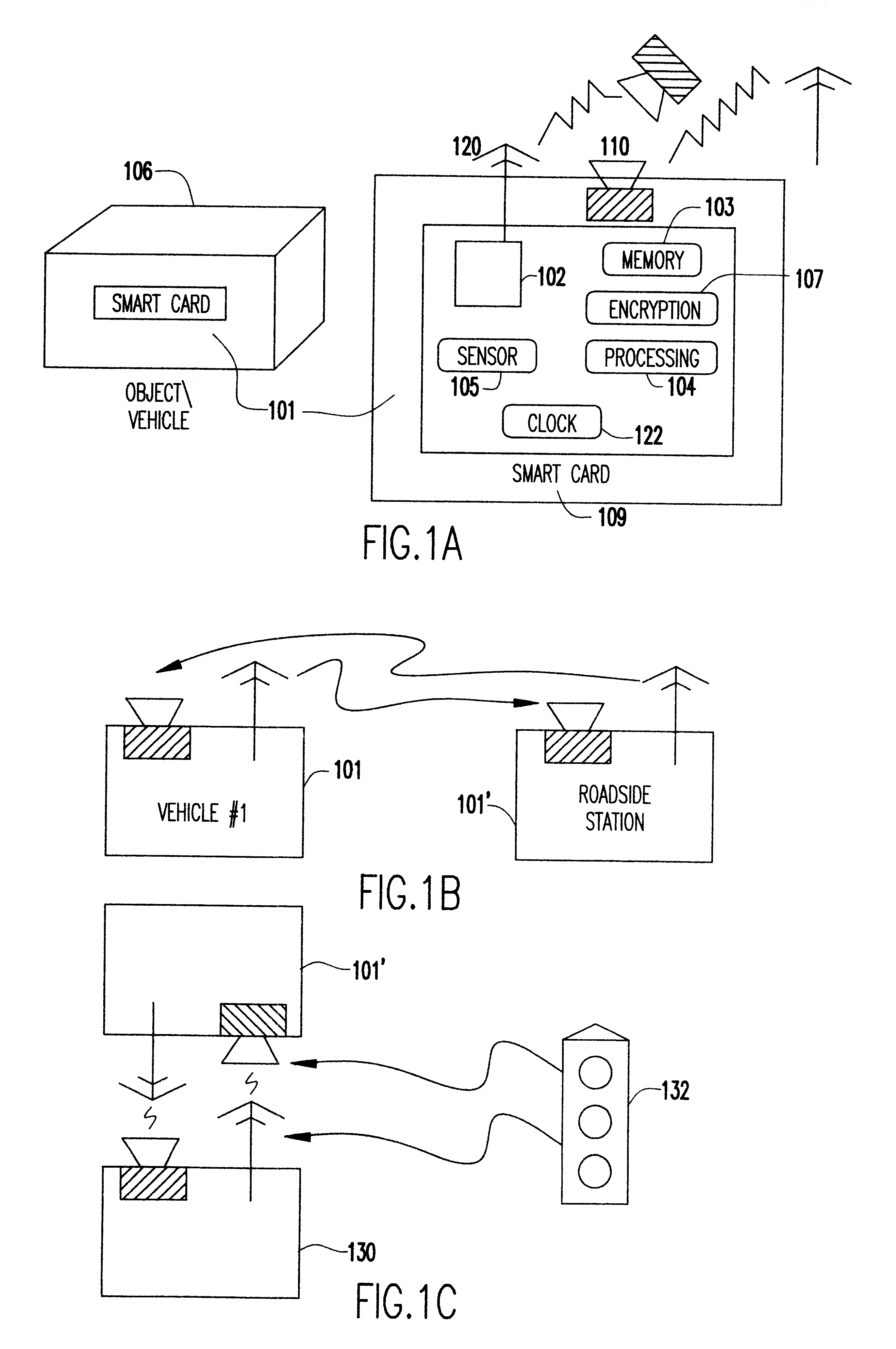

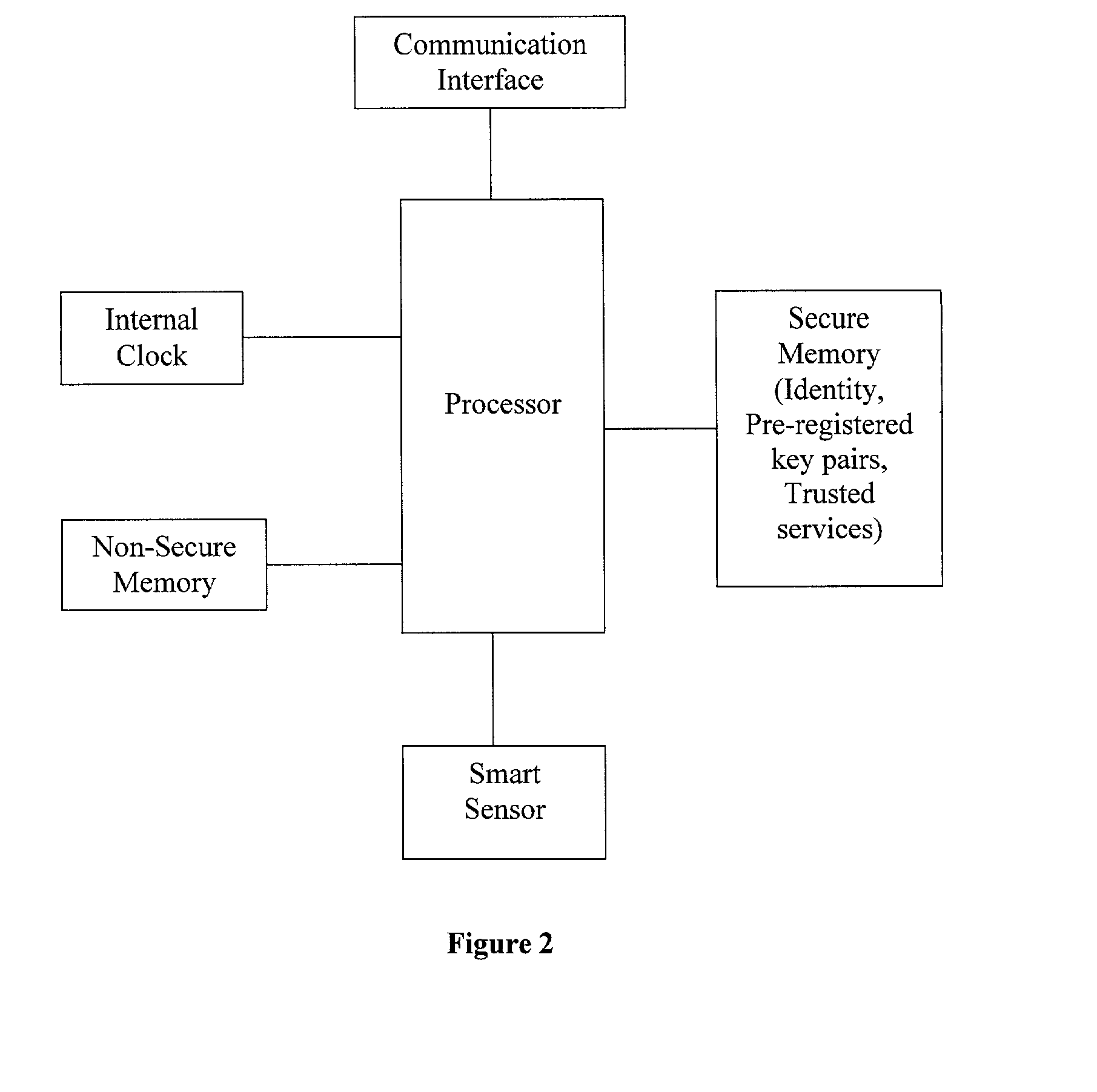

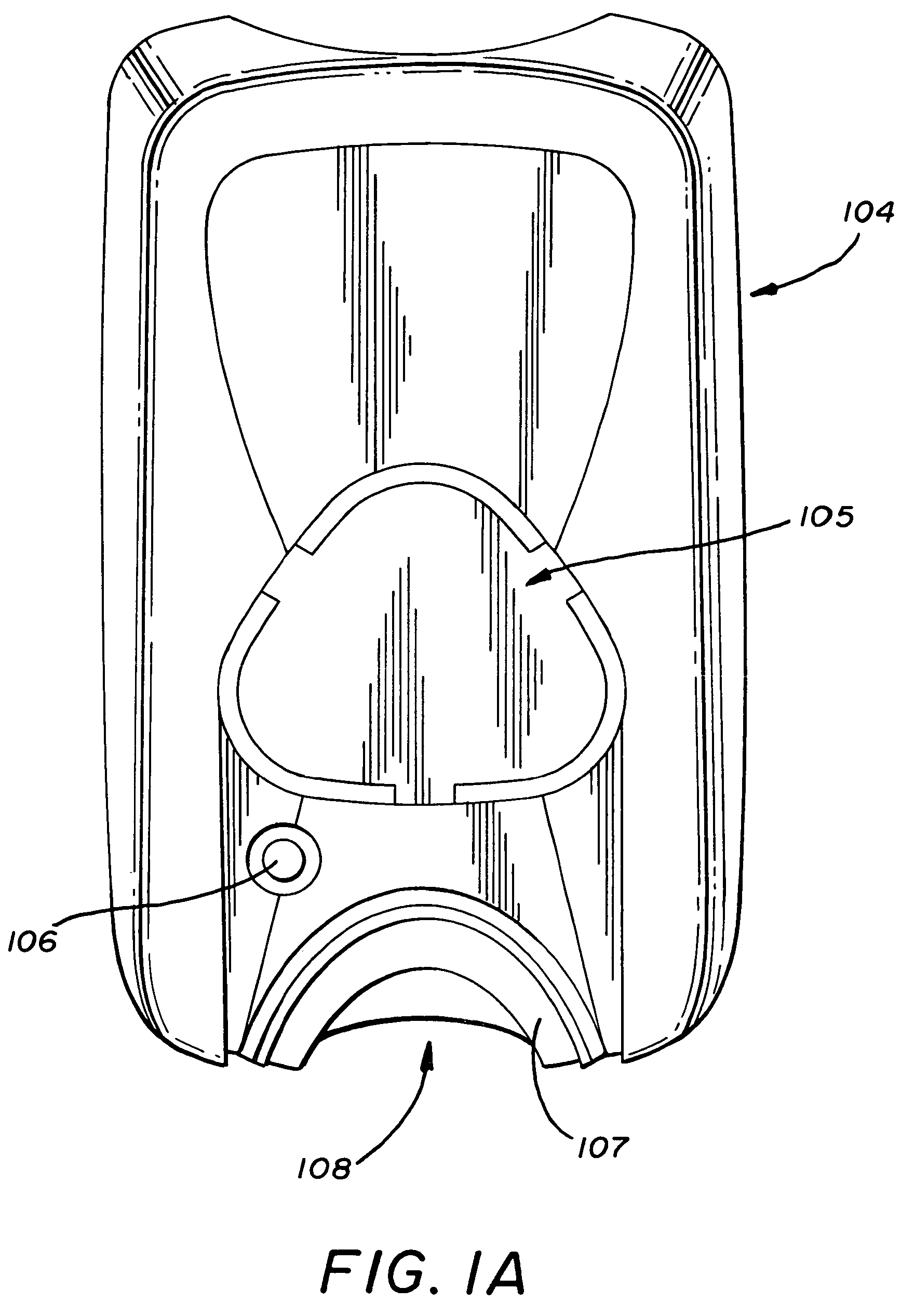

Event-recorder for transmitting and storing electronic signature data

An electronic event recorder for attachment to a vehicle is provided which can broadcast encrypted signature and data, thereby leaving behind an electronic version of a "fingerprint" in the event of an accident or traffic violation. The fingerprint, captured by an external data acquisition system or another vehicle so equipped, provides a history of events related to the vehicle. The event recorder is preferably integrated on a smart card and housed in a tamper proof casing. In a first mode of operation, monitoring stations along the roadways periodically send an interrogation signal, such as when radar detects that the vehicle is speeding. Upon receiving the interrogation signal the smart card transmits the vehicle's signature information to the monitoring station where it is time and date stamped along with the speed of the vehicle. In a second mode of operation, when a sensor detects a sudden or violent acceleration or deceleration, such as occurs during a collision, a smart card mounted in each car will exchange signature information automatically. This is particularly useful when the collision occurs in a parking lot when one of the hit vehicles is typically unattended.

Owner:INT BUSINESS MASCH CORP

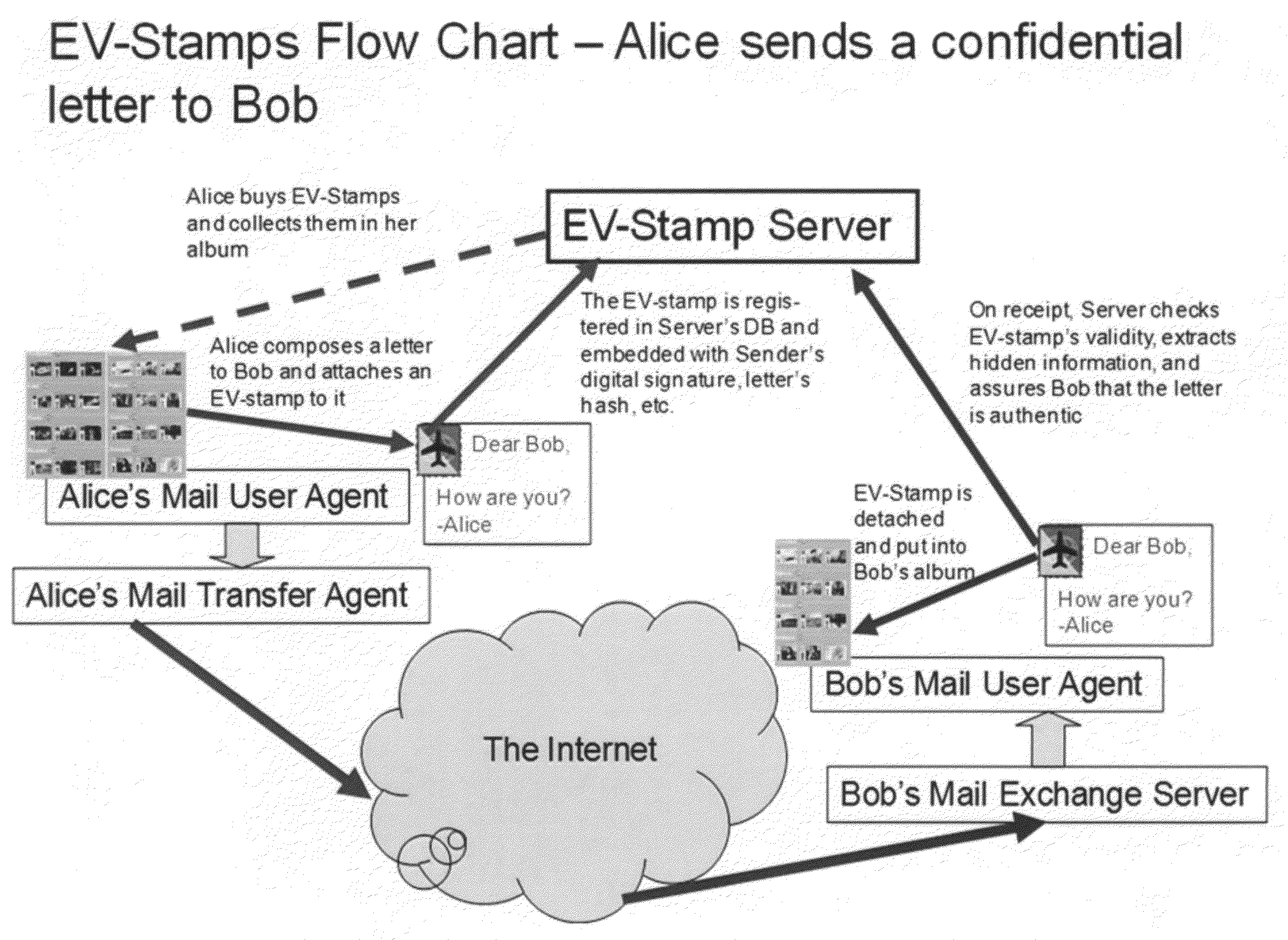

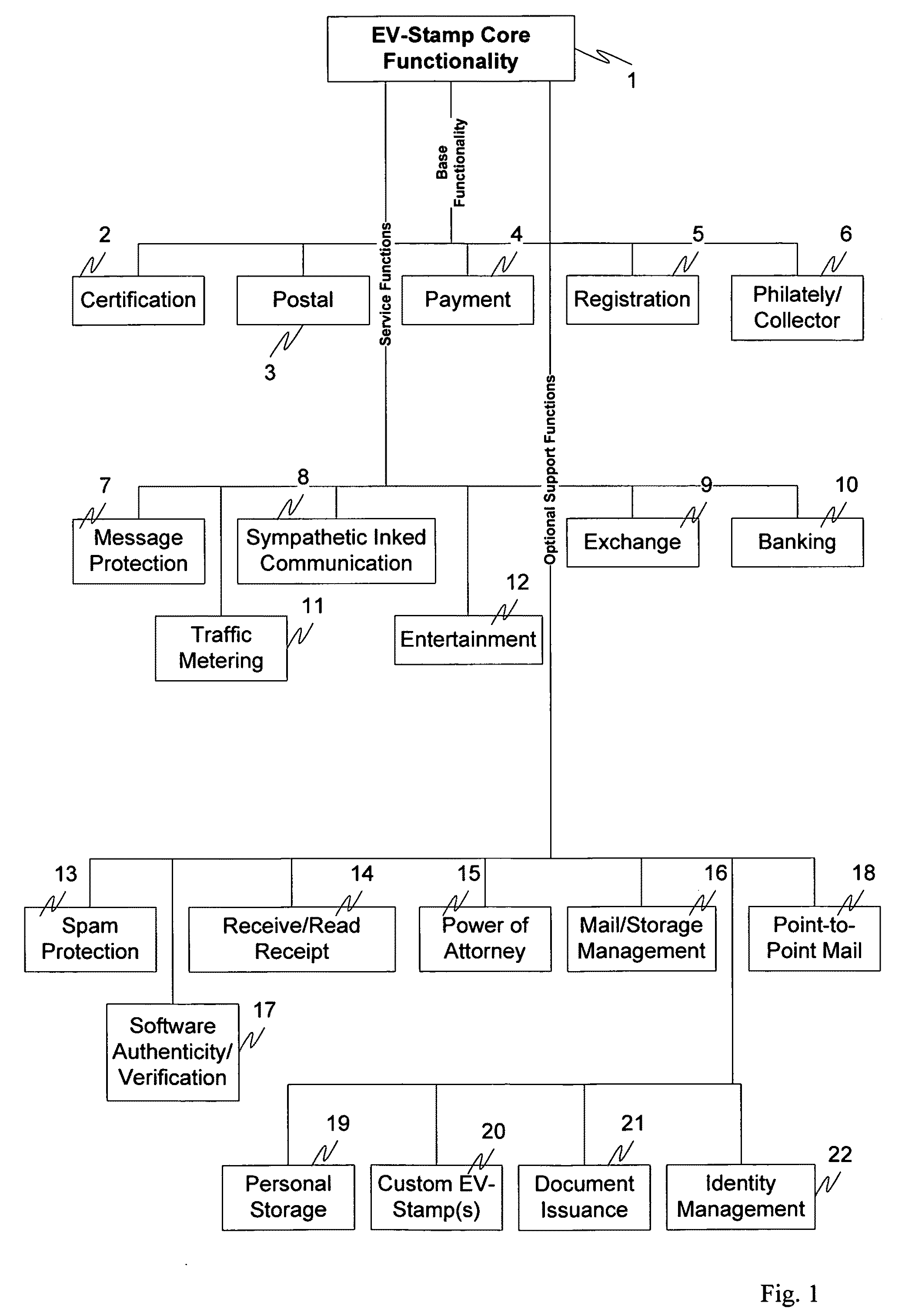

Electronic certification, identification and communication utilizing encrypted graphical images

A system and method for electronic certification, identification and communication. According to an exemplary implementation, these processes are performed by using an electronic graphic image with encrypted information concerning the certified object. The object is accompanied with an application specific image hereafter called Electronic Virtual Stamp (EV-Stamp) having embedded and encrypted control information (keys and electronic signatures, identifiers of senders and receivers, date and other transaction related information) as well as any message to be passed. Each transaction of the EV-Stamp is monitored by a specialized Web server that maintains the records of all issued electronic stamps, all subscribed users, all involved financial transactions, and all registered assets. It is also possible to use any other graphical images to reflect on various possible applications such as exchange of the EV-Stamp for a good / service.

Owner:ASTAKHOV PAVEL

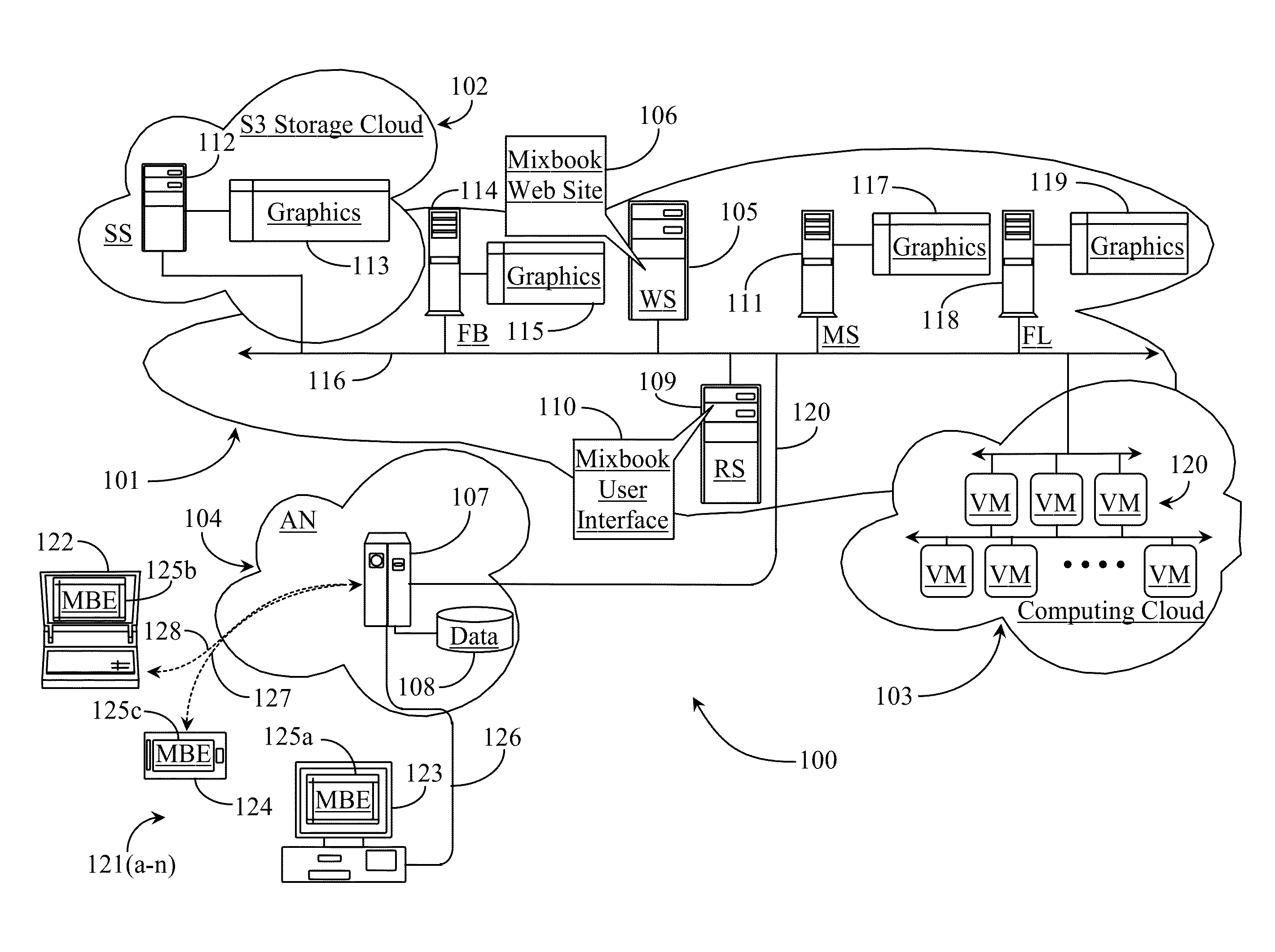

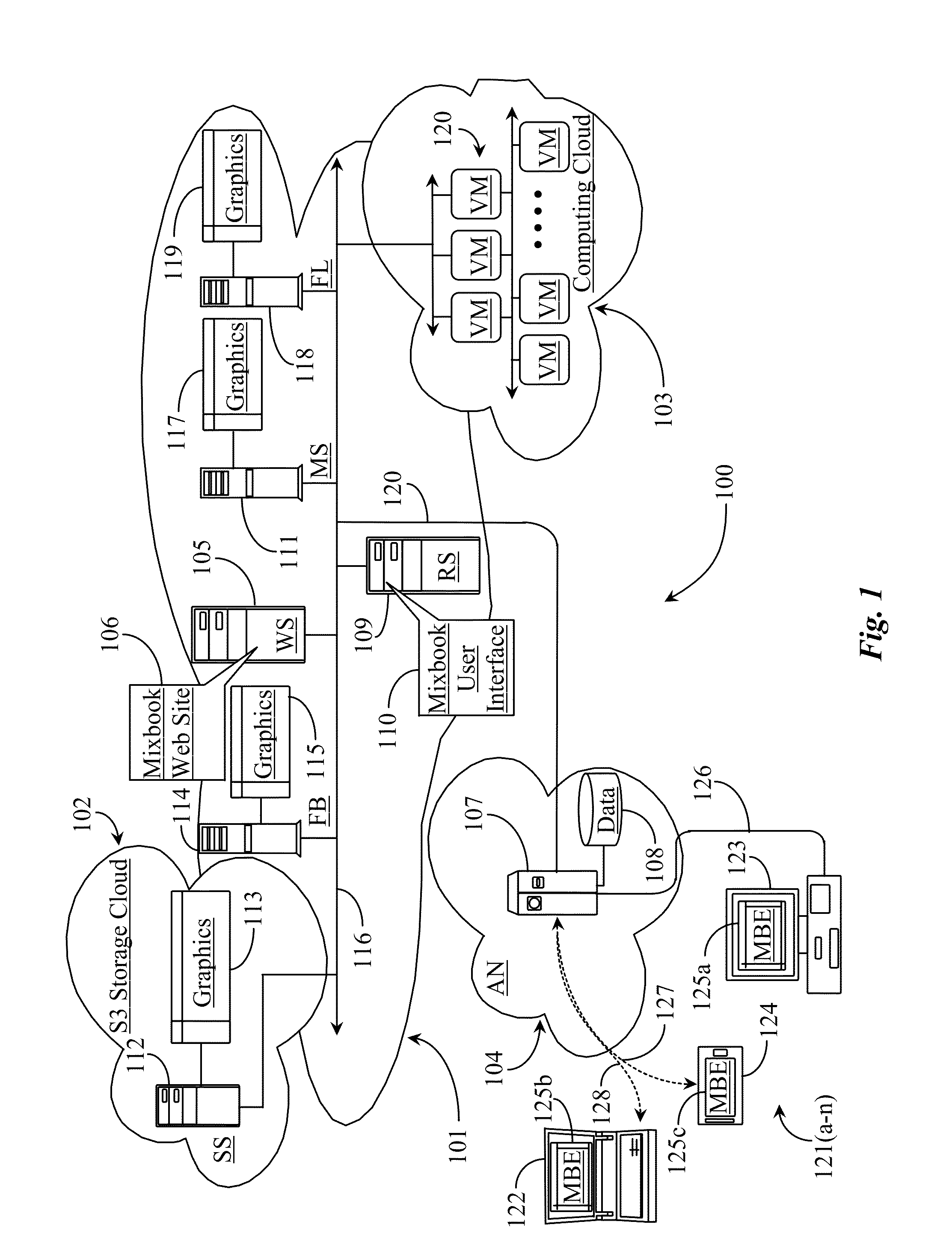

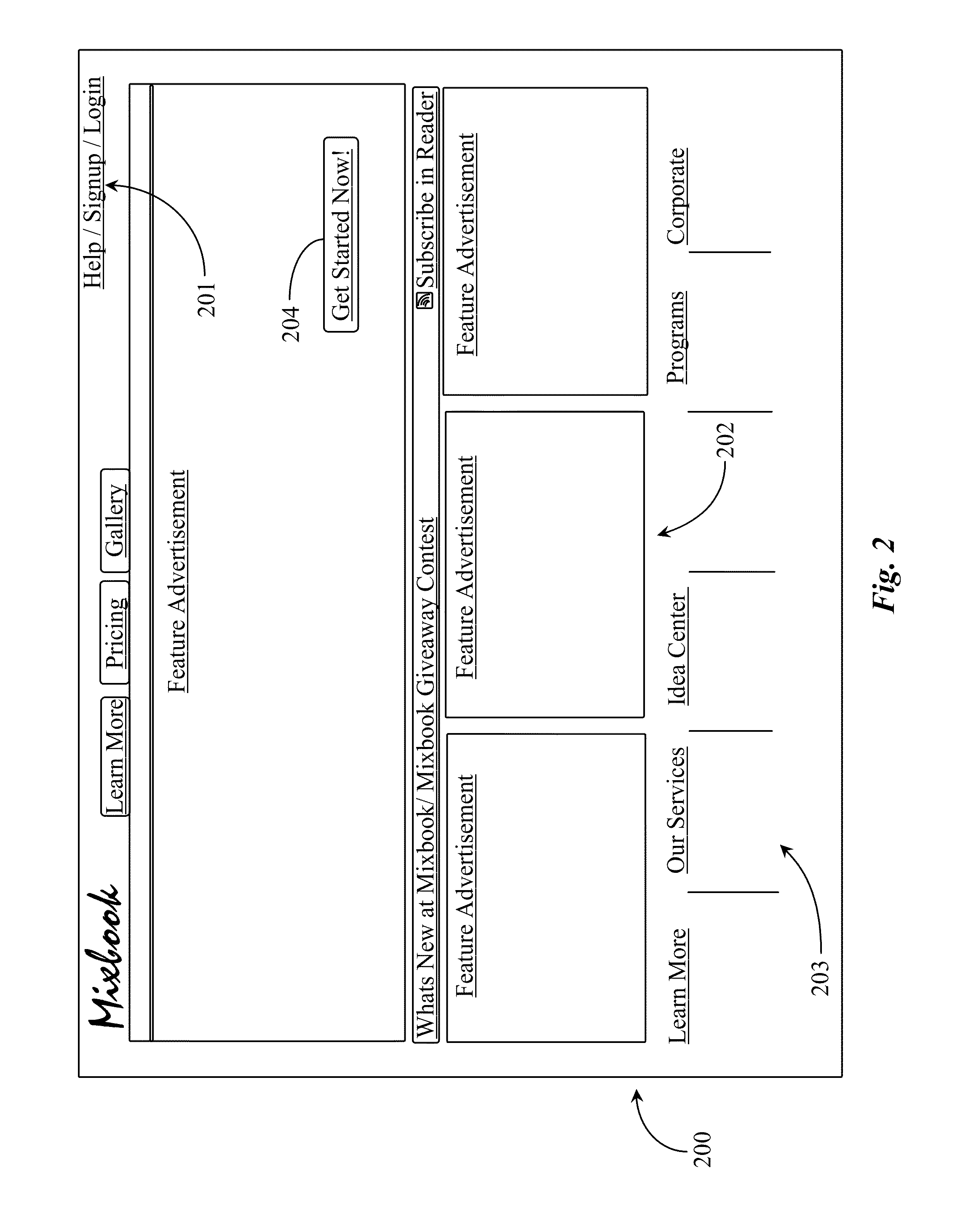

Method for Dynamic Bundling of Graphics Editing Tools presented to Clients engaged in Image-Based Project Creation through an Electronic Interface

InactiveUS20140096029A1Still image data indexingNatural language data processingGraphicsGraphical user interface

A system for creating image and or text-based projects includes a server, the server having access to a processor, a data repository, and a non-transitory physical medium. Software running from the non-transitory physical medium provides a first function for establishing a client server connection between the server and at least one user-operated computing appliance connected to the network, a second function for initiating and maintaining an active data session between one or more users involved in project creation and or in project editing through a graphics user interface (GUI), a third function for detecting user-execution of a project template, a fourth function for analyzing the exact nature and state of the template and any content associated therewith, a fifth function for assembling a customized editing interface according to needs determined by the analysis of the fourth function, and a sixth function for presenting the customized interface to the user.

Owner:INTERACTIVE MEMORIES

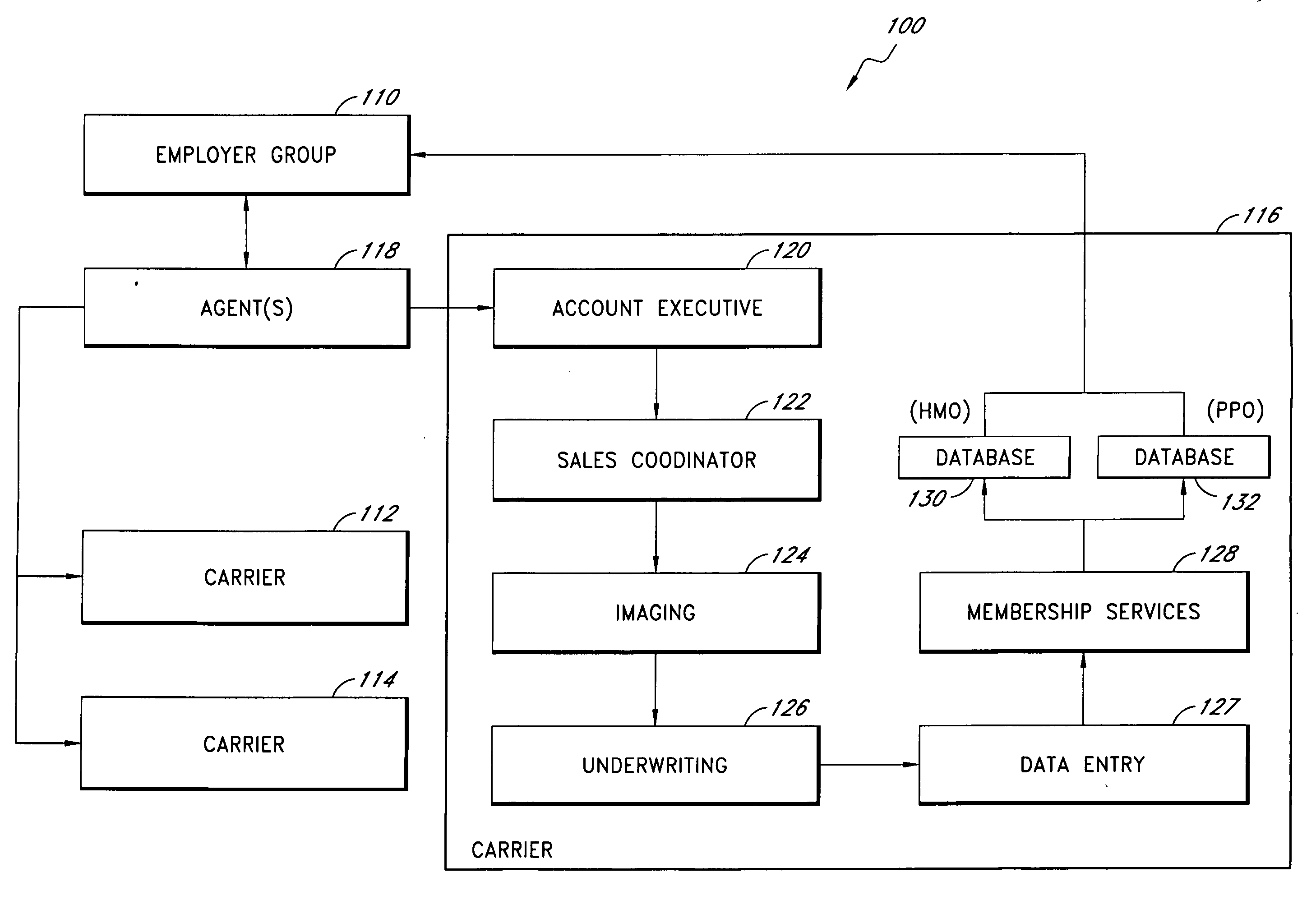

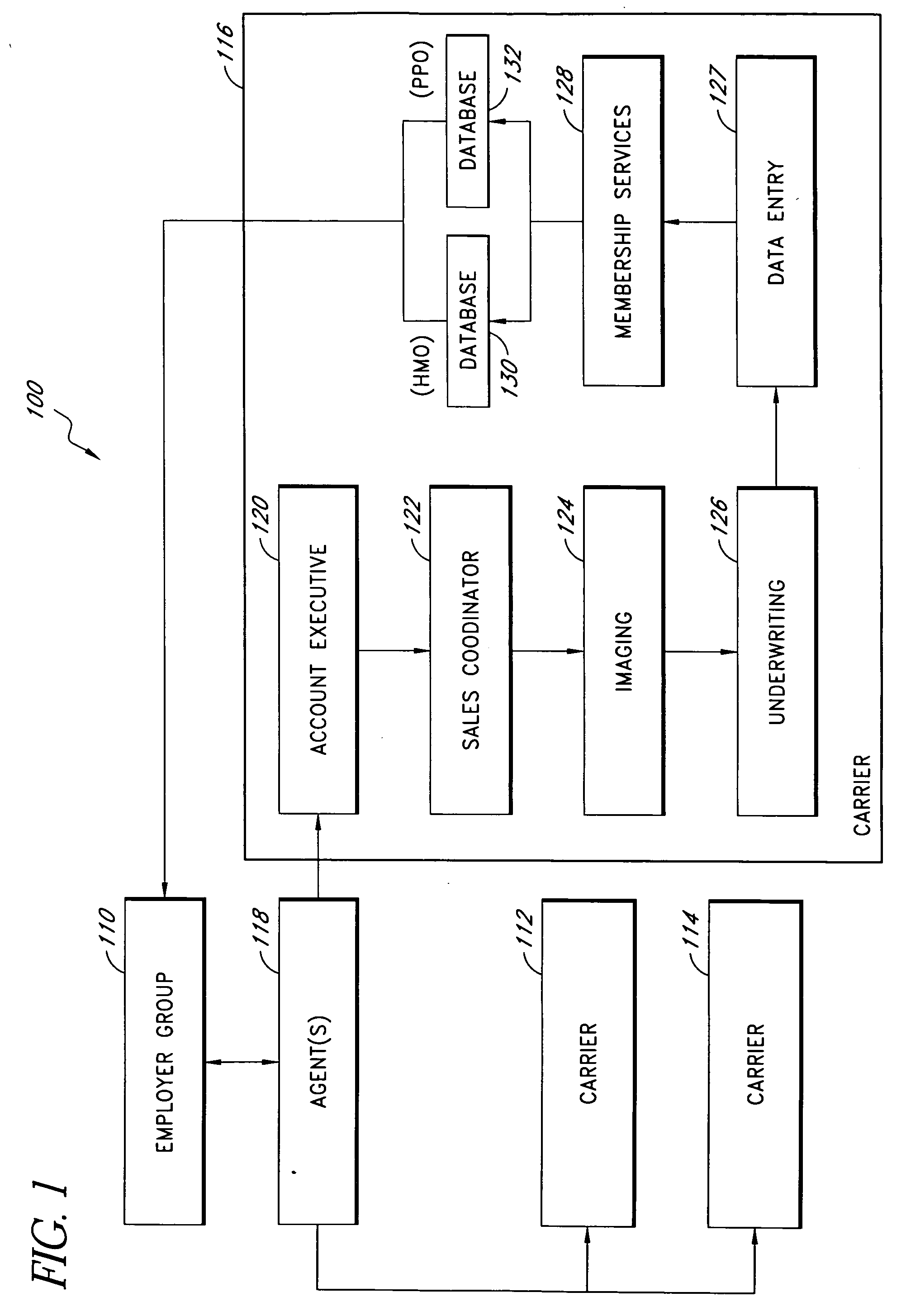

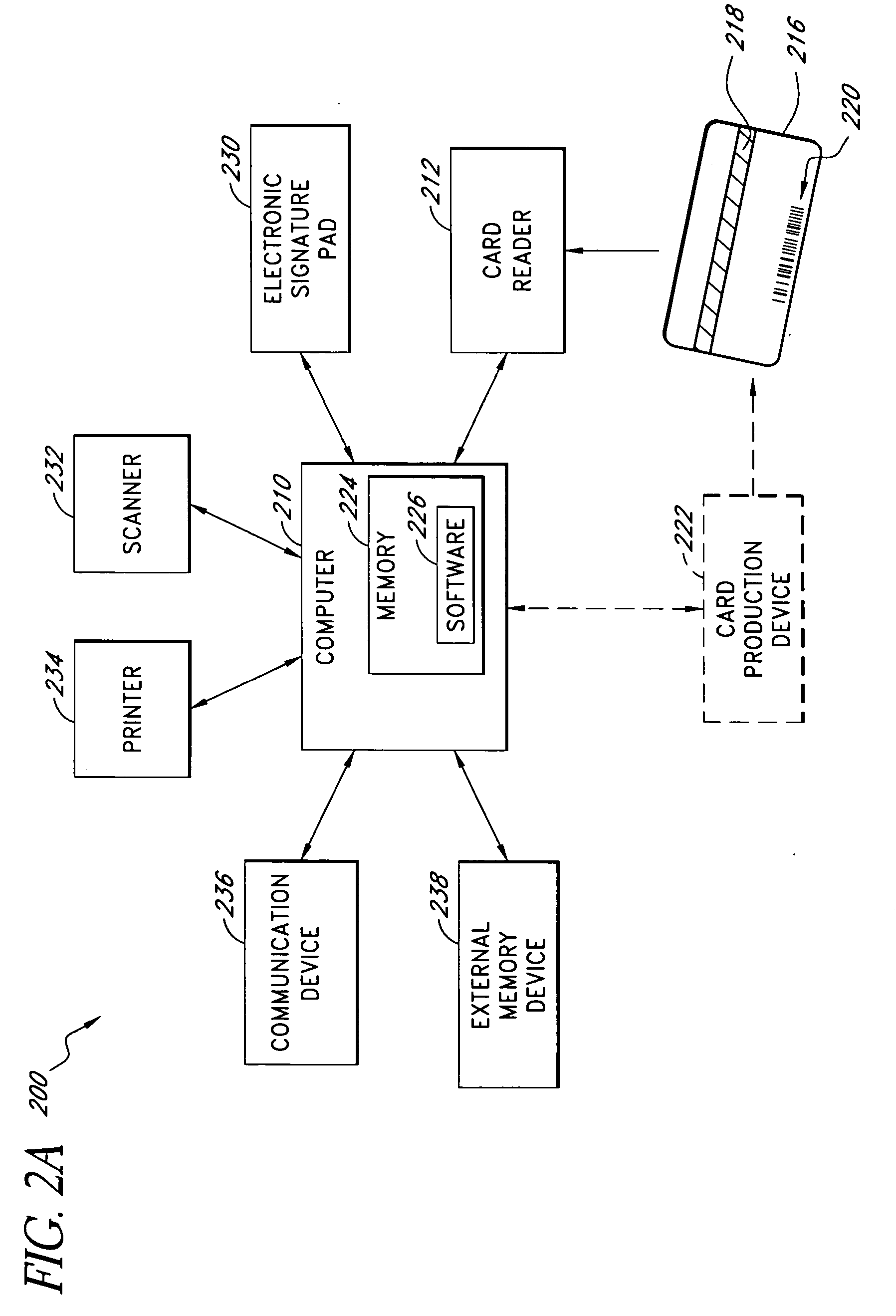

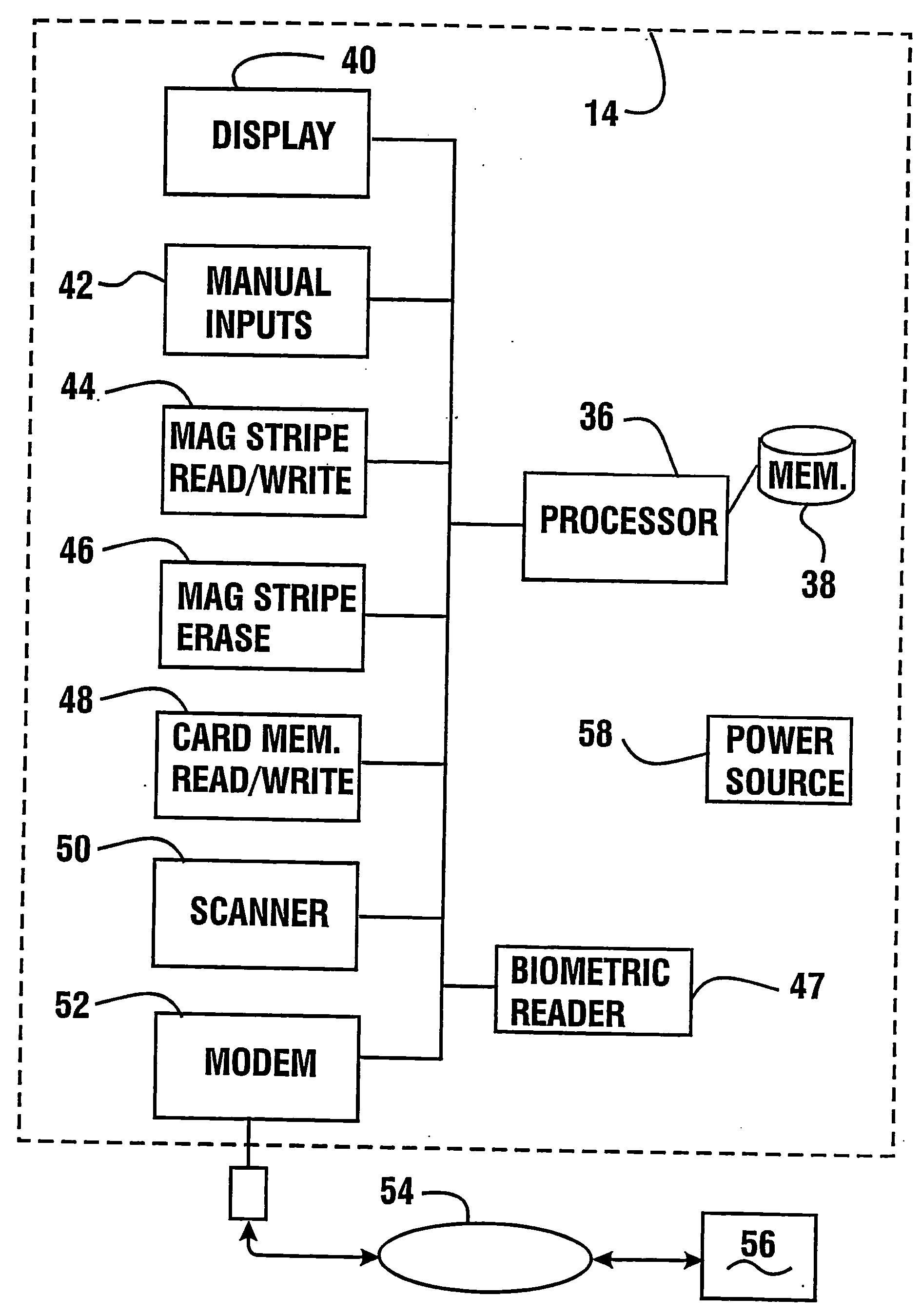

Systems and methods for automating the capture, organization, and transmission of data

InactiveUS20050080649A1FinanceSpecial data processing applicationsDocumentation procedureData system

Systems and methods automate data entry and processing. Data is automatically entered into a system by reading a user identification card. The data can be supplemented with additional information, if necessary, and processed by the system. In one embodiment, the data is used to register an employee for an employee benefit program offered by a provider such as an insurance carrier. The data read from the identification card is automatically entered into an electronic enrollment form where the user can check it. Documentation corresponding to the enrollment form can be converted to an electronic copy, if necessary, and attached to the enrollment form. Once the enrollment form is complete, the user can electronically sign the enrollment form and send it through a computer network to the provider. The provider may then process the enrollment form, request additional information or corrections from the user, and register the user for the products or services.

Owner:BENEFITSDOMAIN COM INSURANCE SERVICES

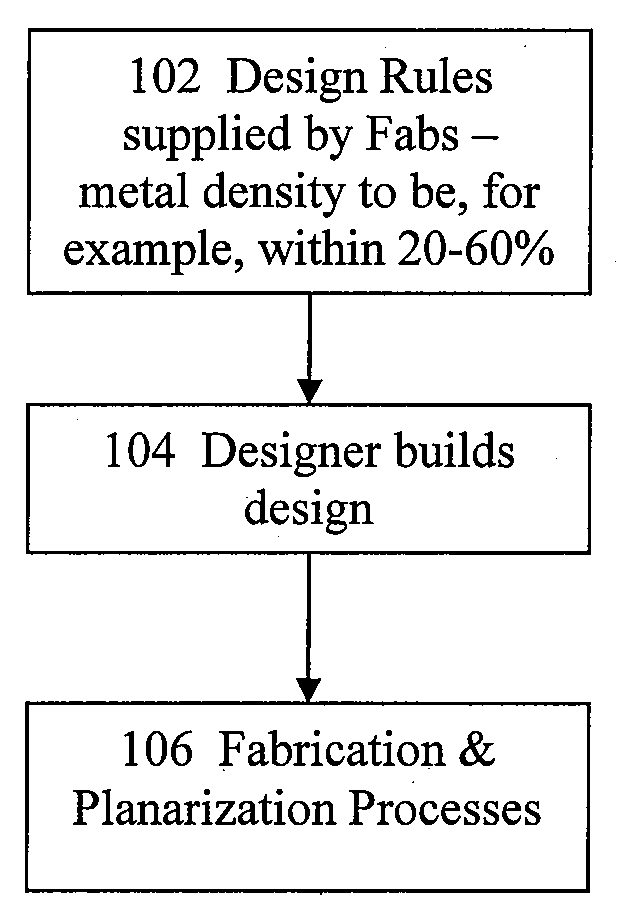

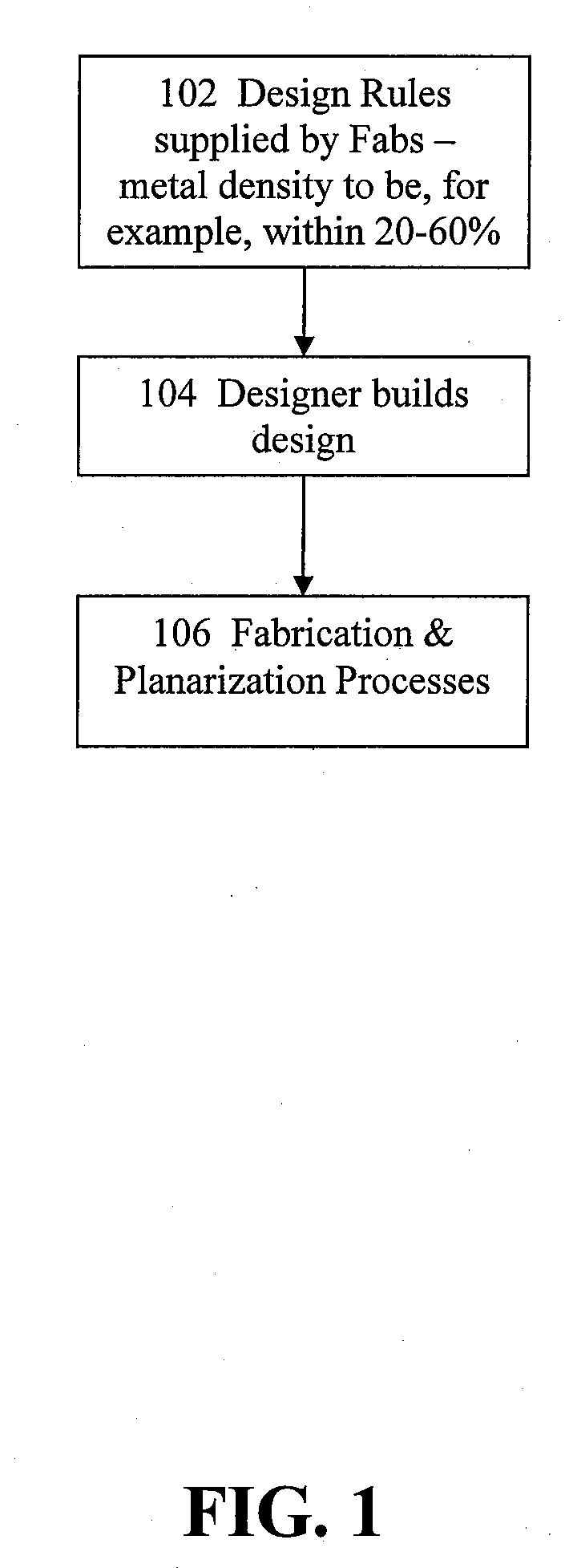

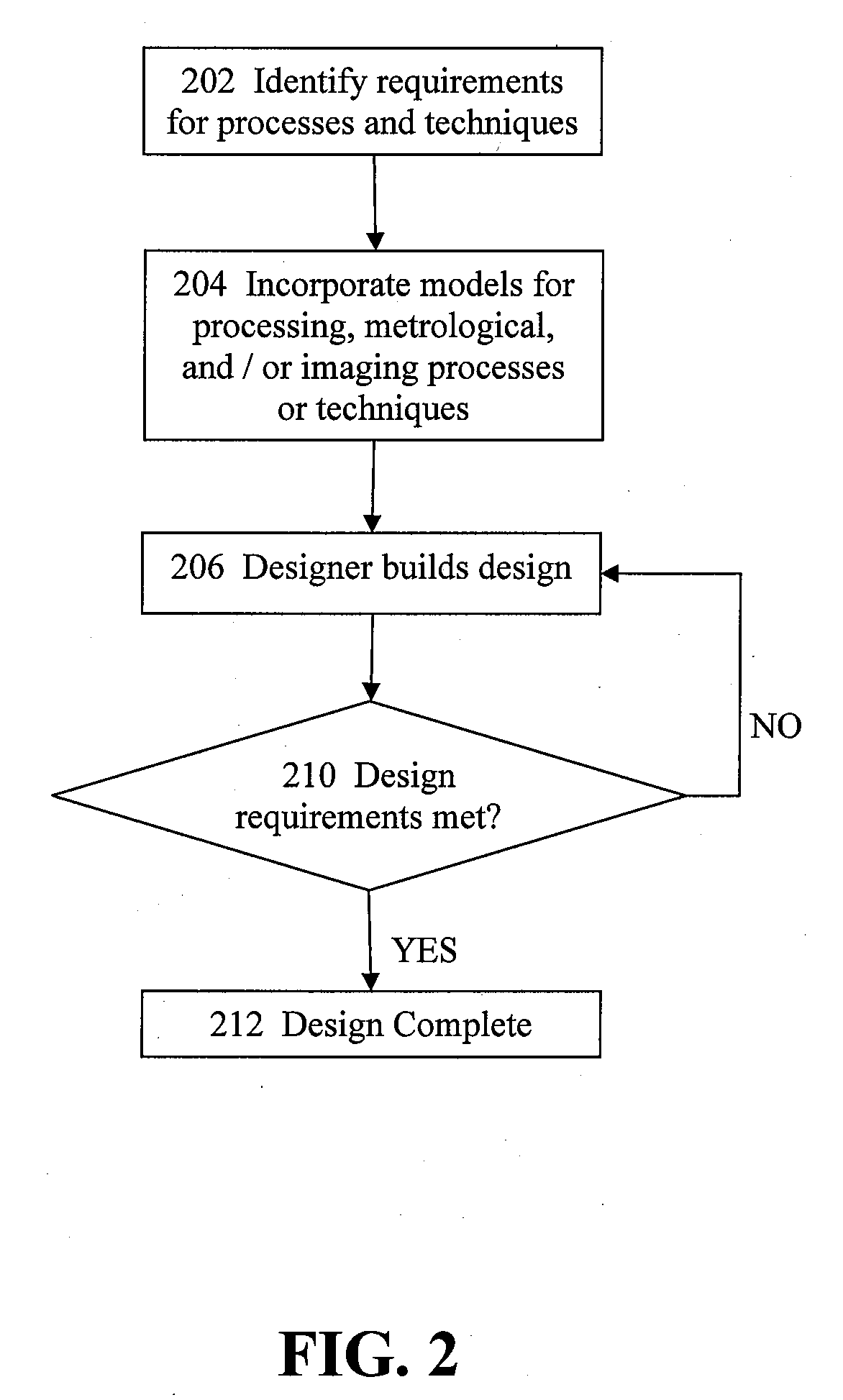

Supplant design rules in electronic designs

ActiveUS20080163141A1Interaction be complexComputer aided designSoftware simulation/interpretation/emulationFoundryComputer architecture

Disclosed is an improved method, system, and computer program product for electronic designs with supplant design rules. According to some embodiments of the invention, the foundry-imposed design rules are replaced by one or more supplant design requirements which define absolute or relative threshold(s) for a design feature characteristic. Some other embodiments of the invention, the foundry-imposed design rules are replaced by one or more supplant design requirements which define one or more ranges of absolute or relative values for a design feature characteristic. Some other embodiments of the invention further provide an EDA tool which takes into account a model for the electronic design, the processing, metrological, lithographic, or imaging processing processes or techniques, and the supplant design requirements to determine whether the features of an electronic design meet the design requirements.

Owner:CADENCE DESIGN SYST INC

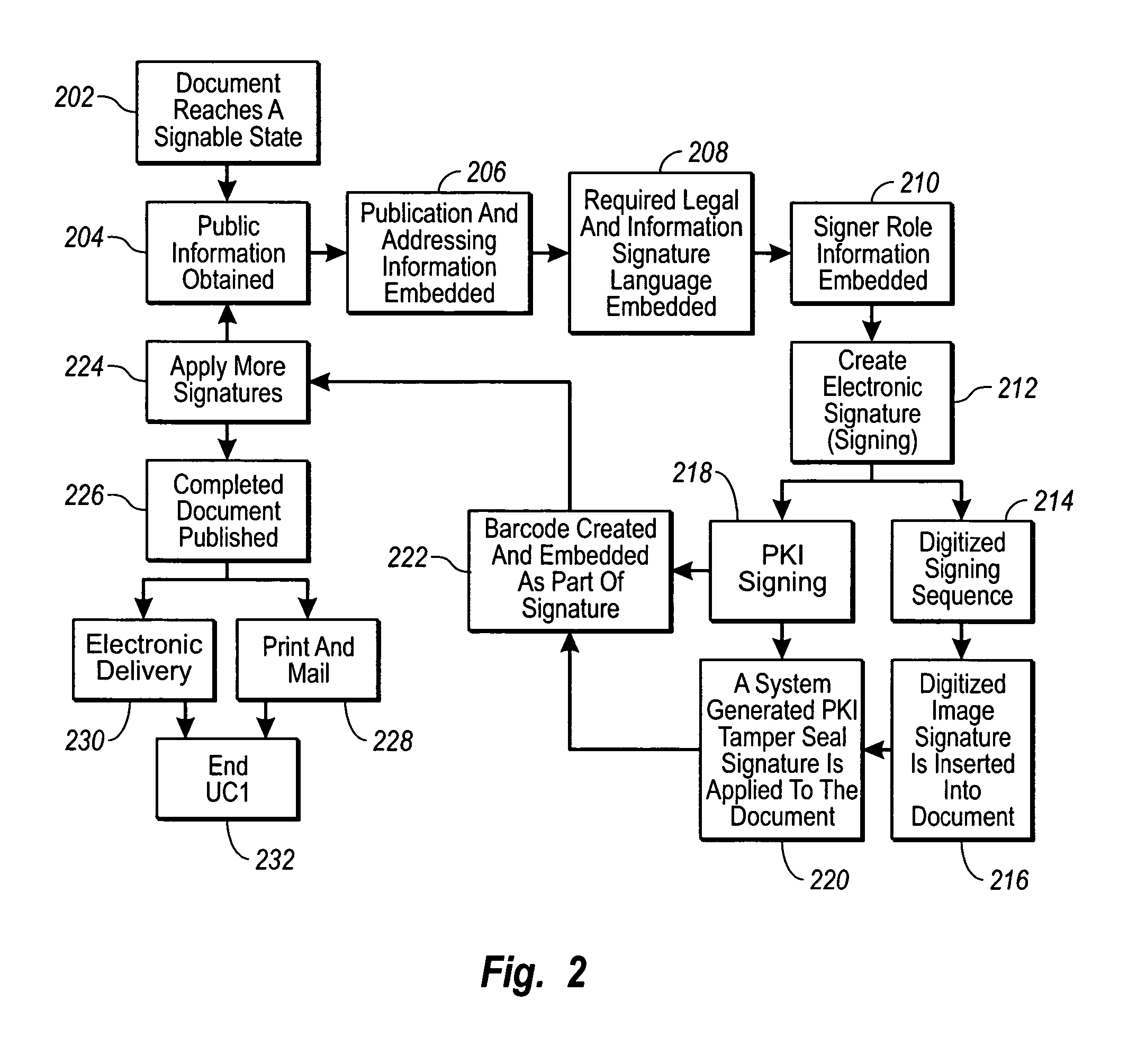

Method and process for creating an electronically signed document

InactiveUS20050138382A1Convenience and efficiency of electronic document processingConvenience and efficiencyUser identity/authority verificationCharacter and pattern recognitionBarcodeDocument preparation

Electronic signatures valid in printed or scanned form. Electronic signatures are embedded in documents such that the electronic signatures are valid even when the document is scanned, printed or stored in paper form. A document includes a barcode embedded into the document. The barcode includes a unique document ID and a unique signature ID identifying the document and the signer of the document. The document also includes language embedded into the document indicating that the signer of the document authorizes paper versions of the document to be accepted as containing a valid electronic signature.

Owner:INGEO SYST

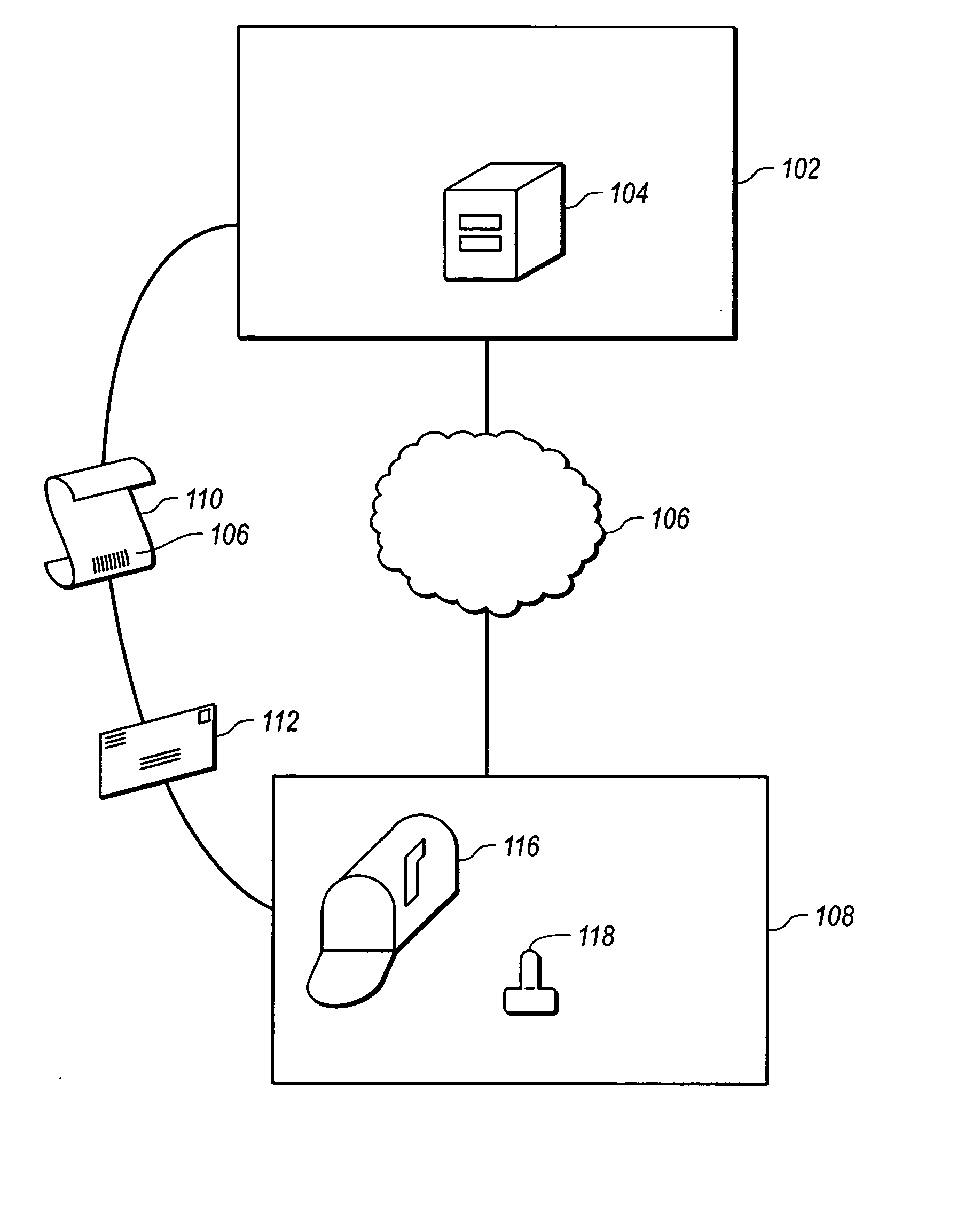

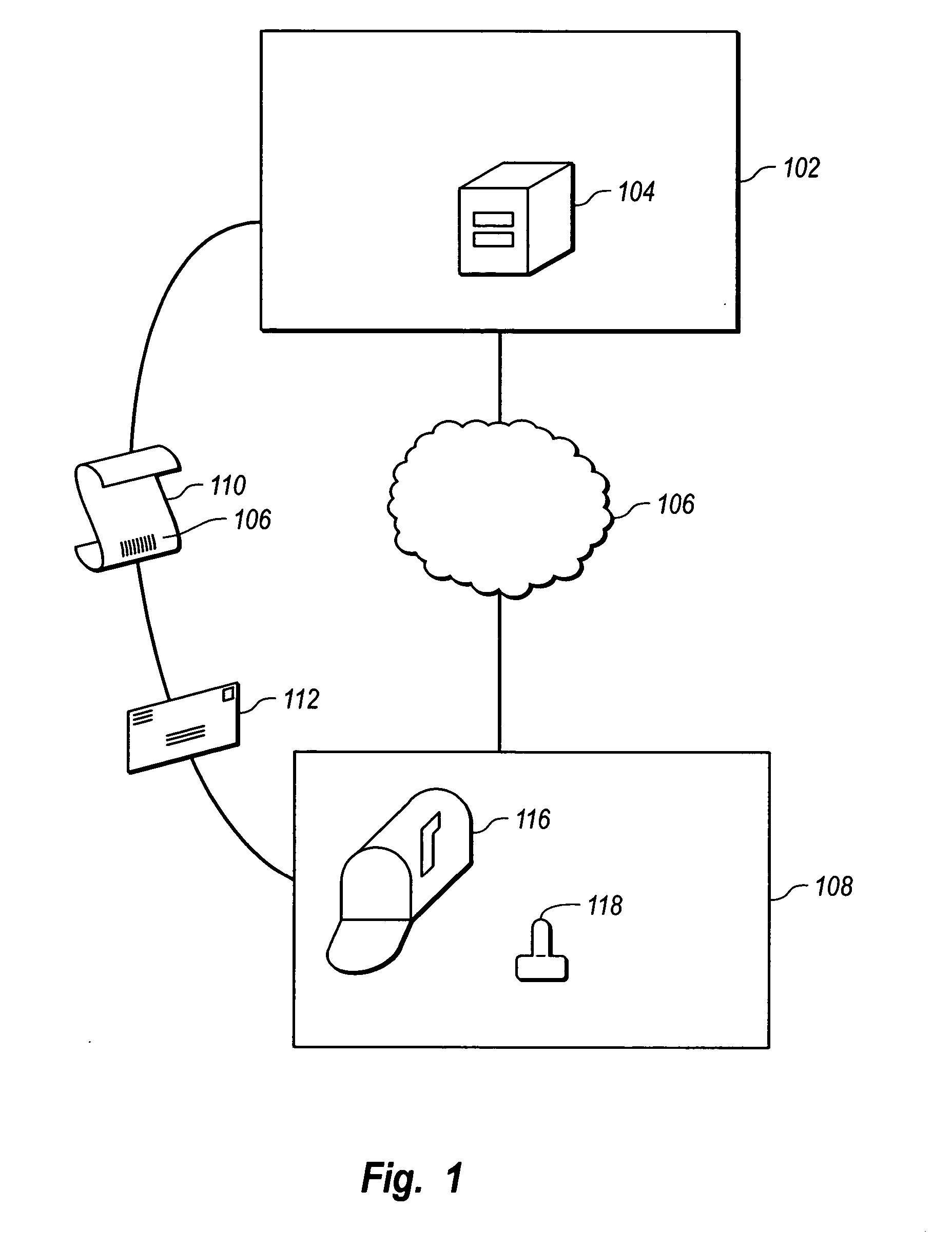

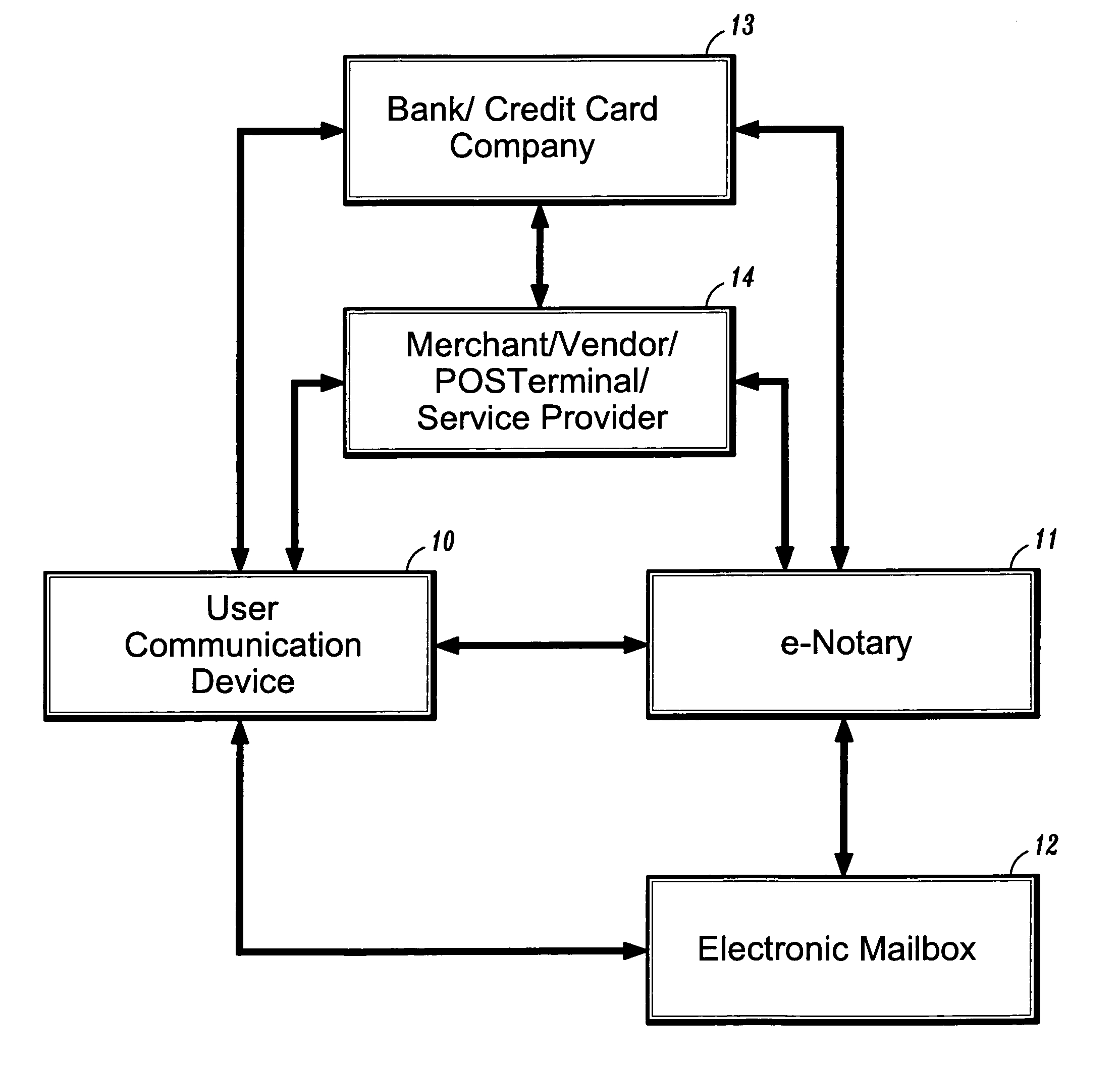

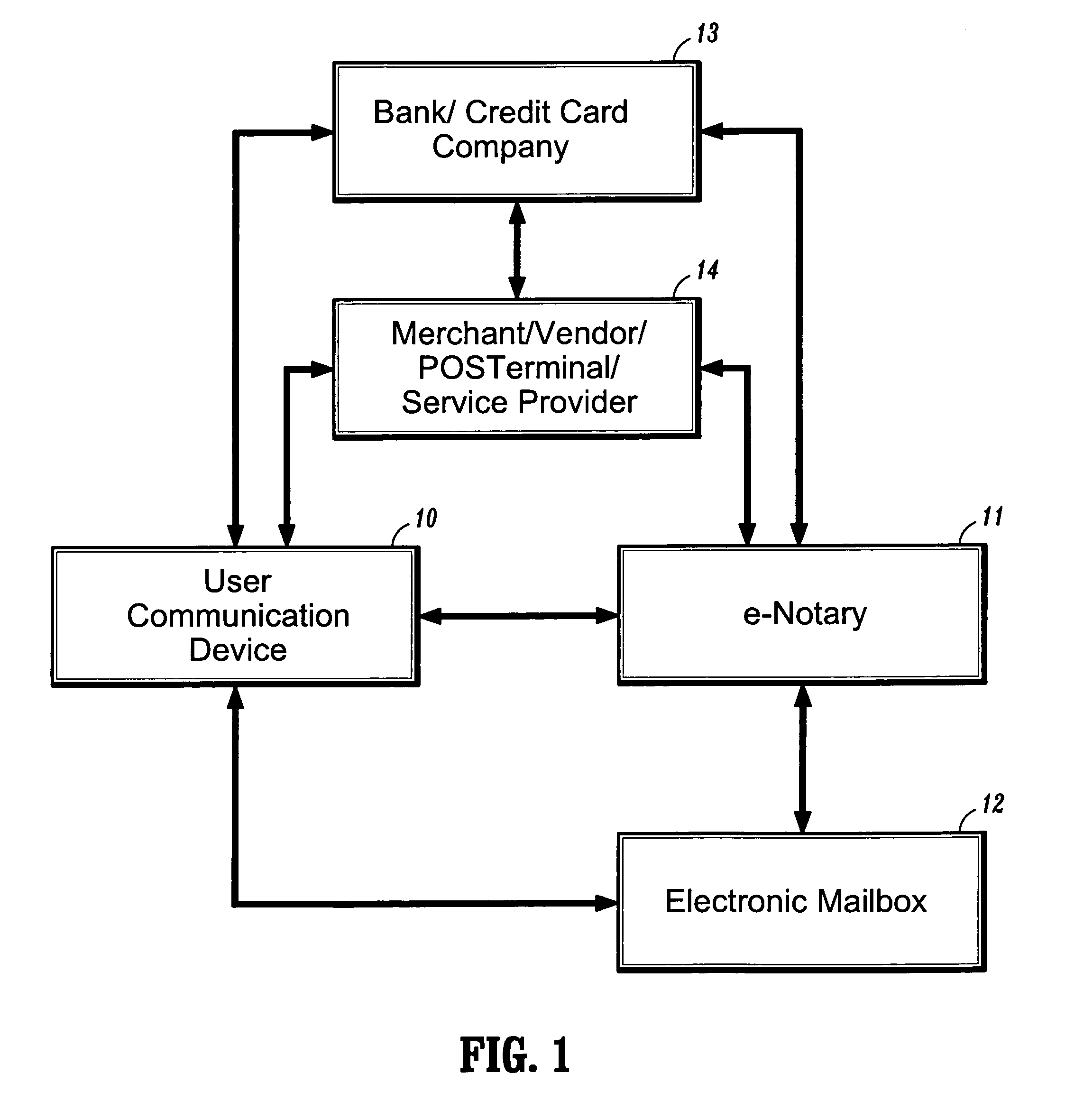

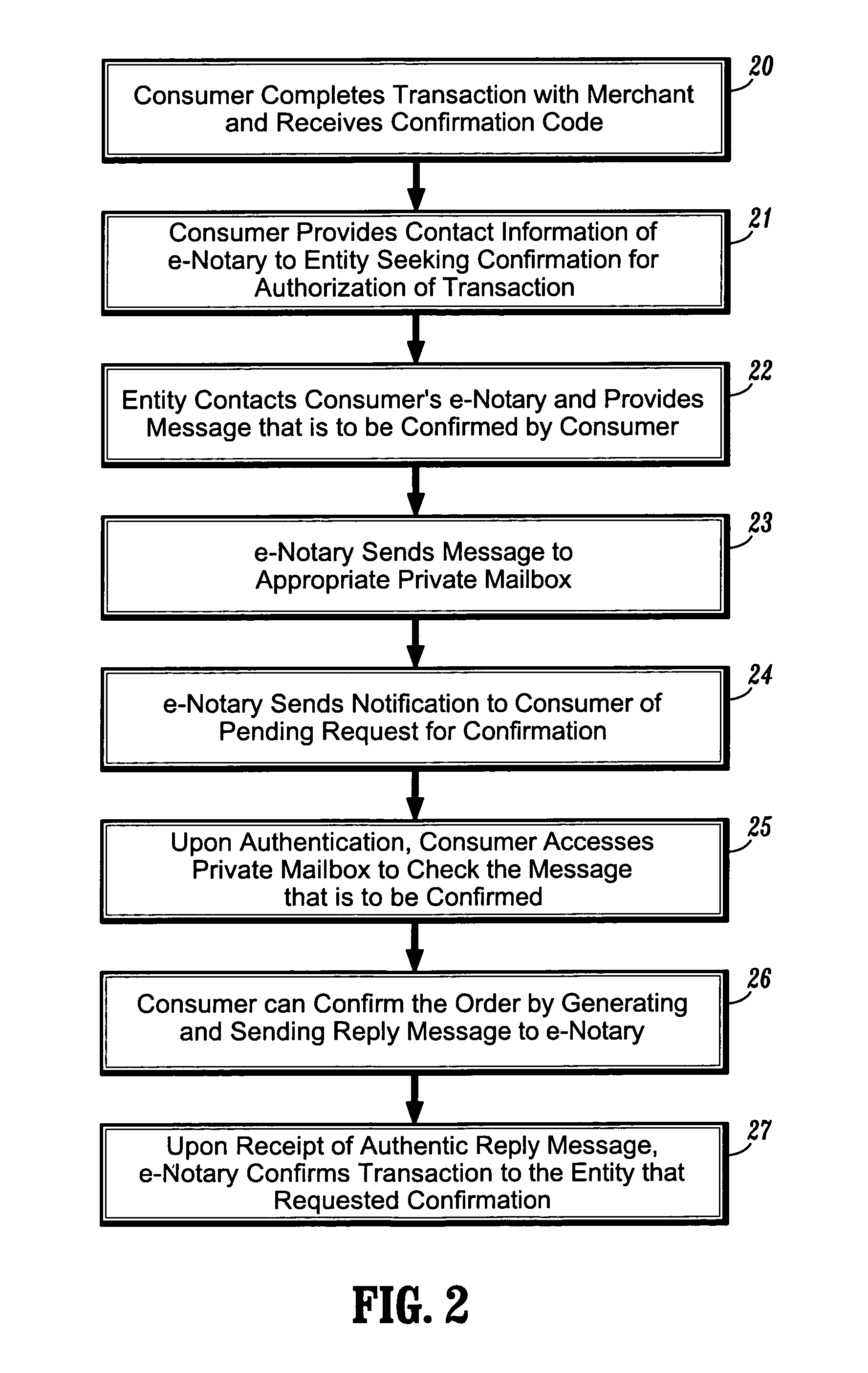

System and method for confirming electronic transactions

Systems and methods for providing user-confirmation of an electronic transaction and in particular, protocols for enabling electronic signatures and confirmation of electronic documents and transactions such as electronic financial transactions and credit card payment. In one aspect, a method for confirming an electronic transaction, comprises the steps of: performing an electronic transaction between a first party and a second party; sending, by the second party, a request for confirmation of the electronic transaction to a predetermined, private mailbox associated with the first party; accessing the private mailbox by the first party; and sending, by the first party, a reply message to the request for confirmation to thereby confirm authorization of the electronic transaction.

Owner:PHONENICIA INNOVATIONS LLC SUBSIDIARY OF PENDRELL TECH +1

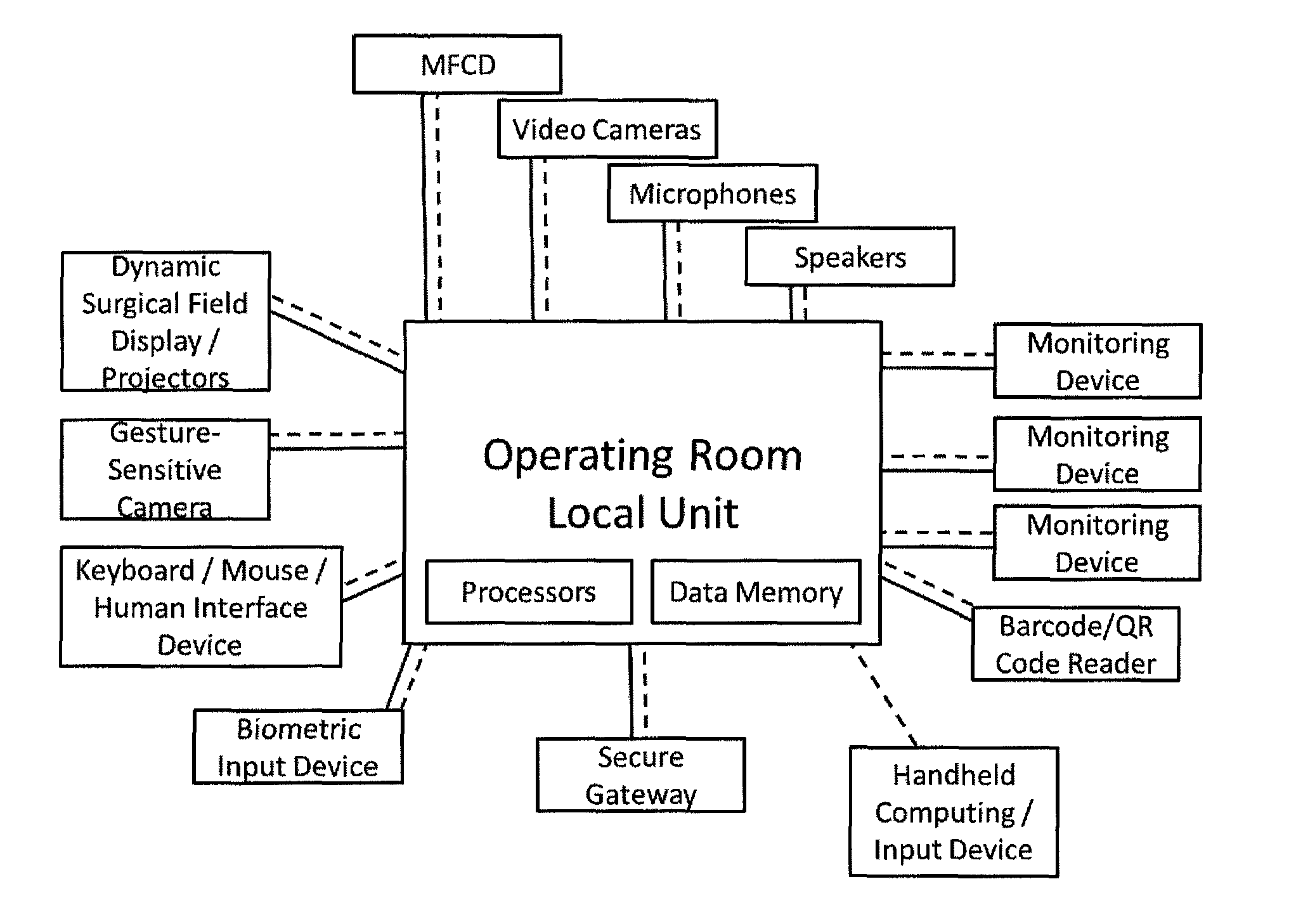

Consolidated healthcare and resource management system

ActiveUS8930214B2Reduce in quantityImprove efficiencySurgical systems user interfaceOffice automationResource Management SystemThe Internet

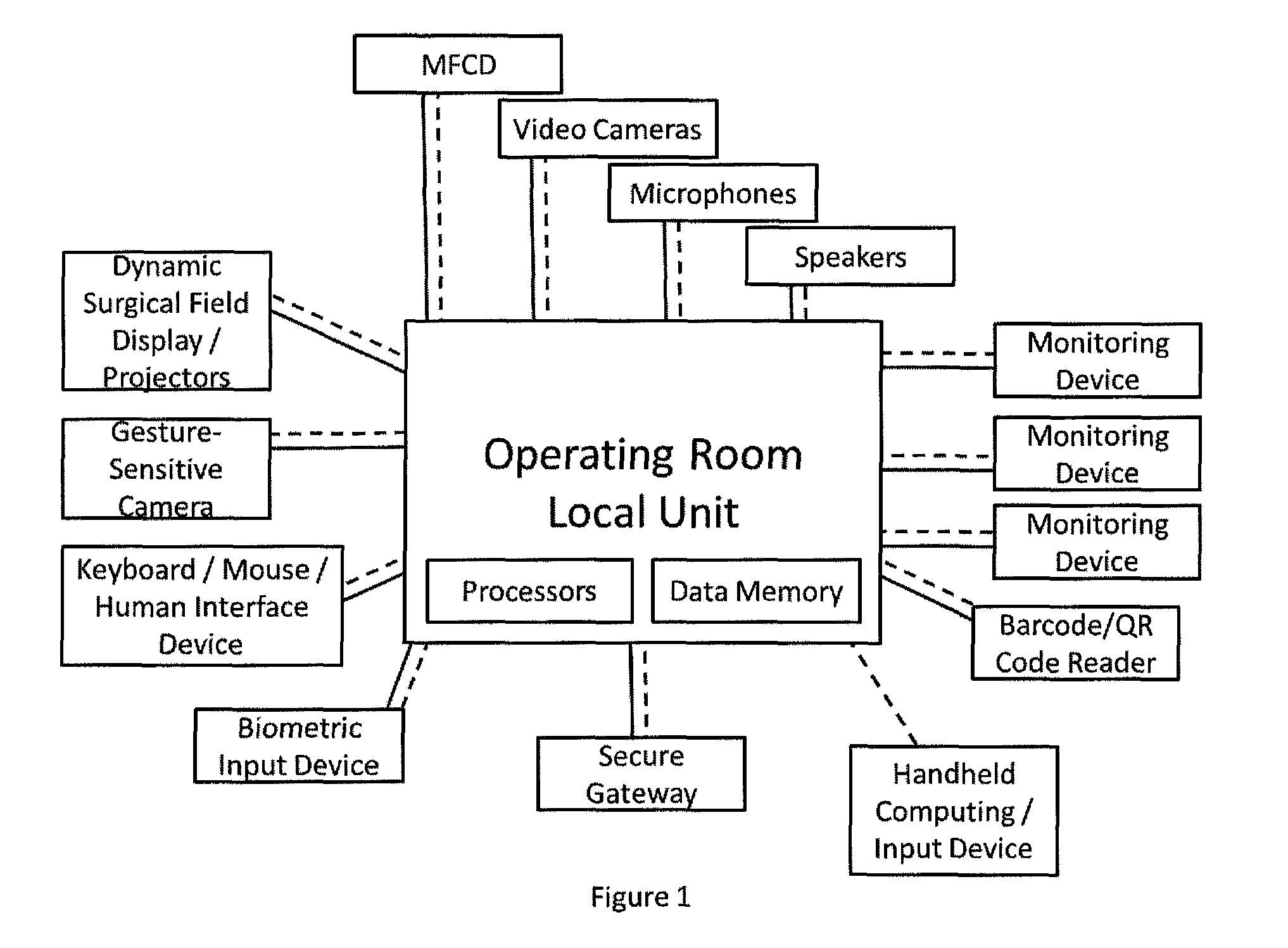

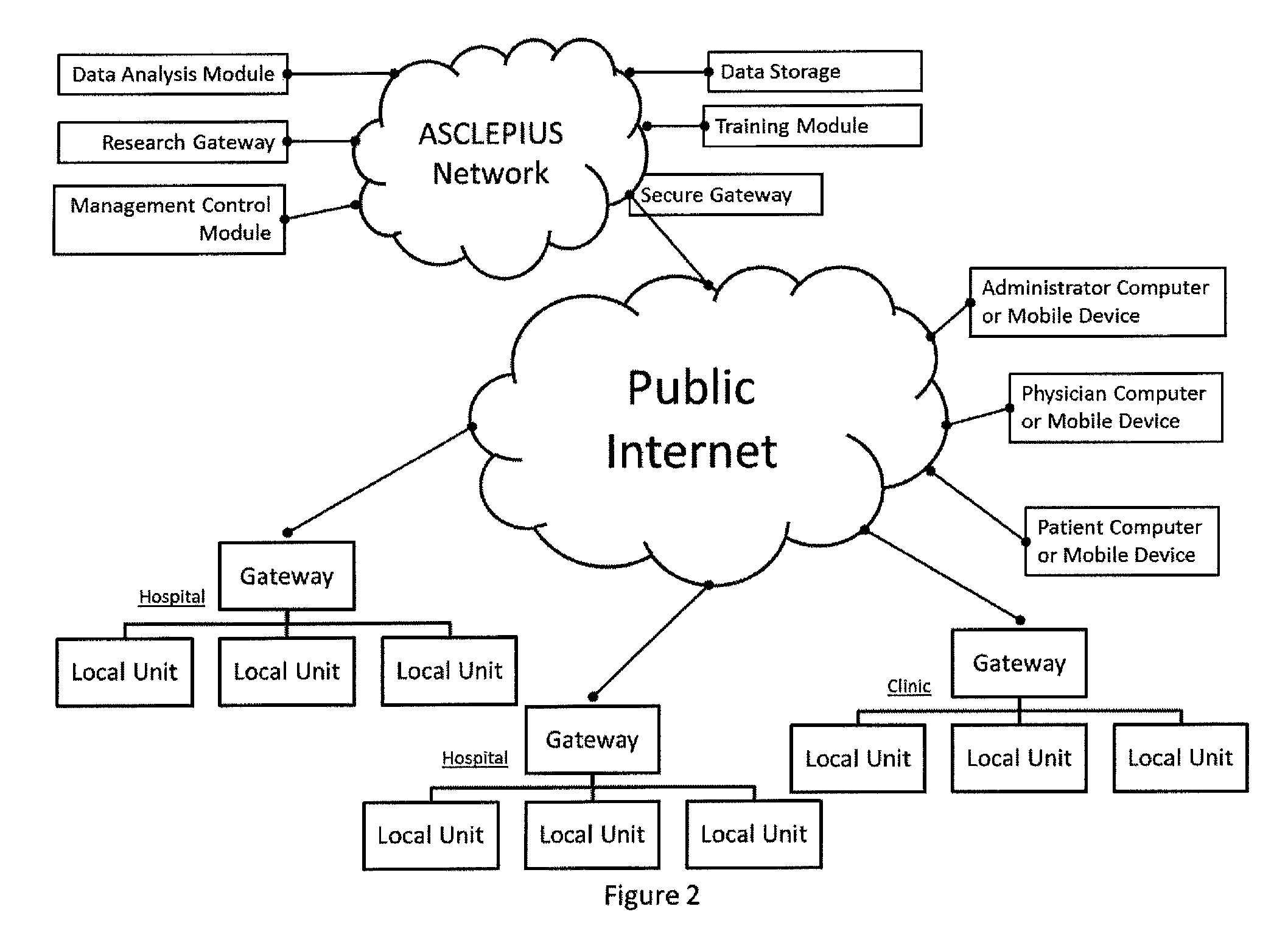

A technical procedure and information enhancement system comprising a multi-function colored display; a computing device having memory and processors; a touch-free gesture-responsive computer input device; computer-readable media containing computer instructions for displaying a plurality of electronic pages selected from the group consisting of a pre-procedural page, a procedure preparation page, an intra-procedural page and a post-procedural page; connection to the internet; a backup memory; a microphone; one or more video cameras situated to record the medical procedure, speakers, and an electronic signature pad.

Owner:PARALLAX ENTERPRISES

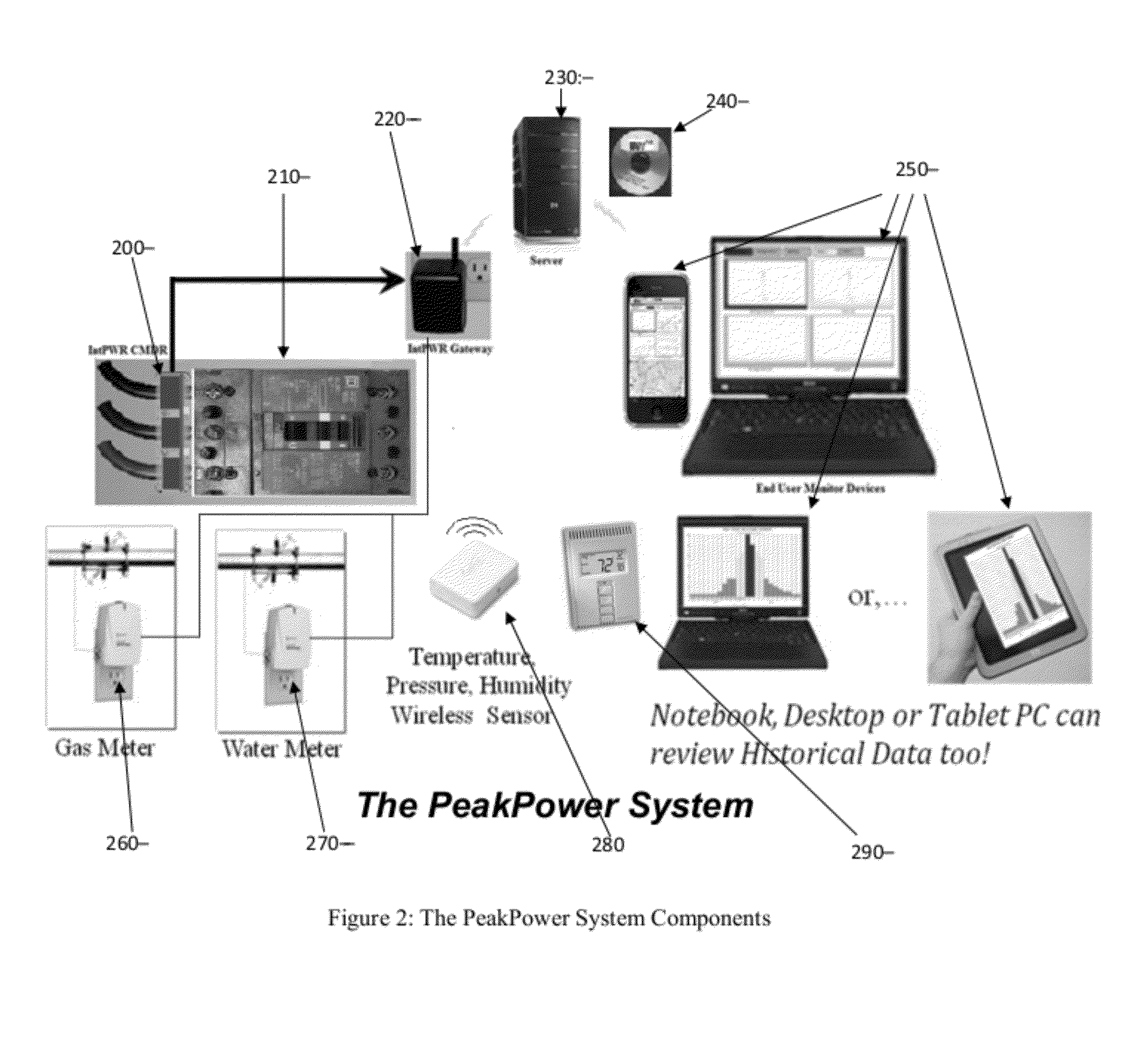

Systems and methods for generating and utilizing electrical signatures for electrical and electronic equipment

InactiveUS20120029718A1Provide controlMechanical power/torque controlLevel controlTransceiverEngineering

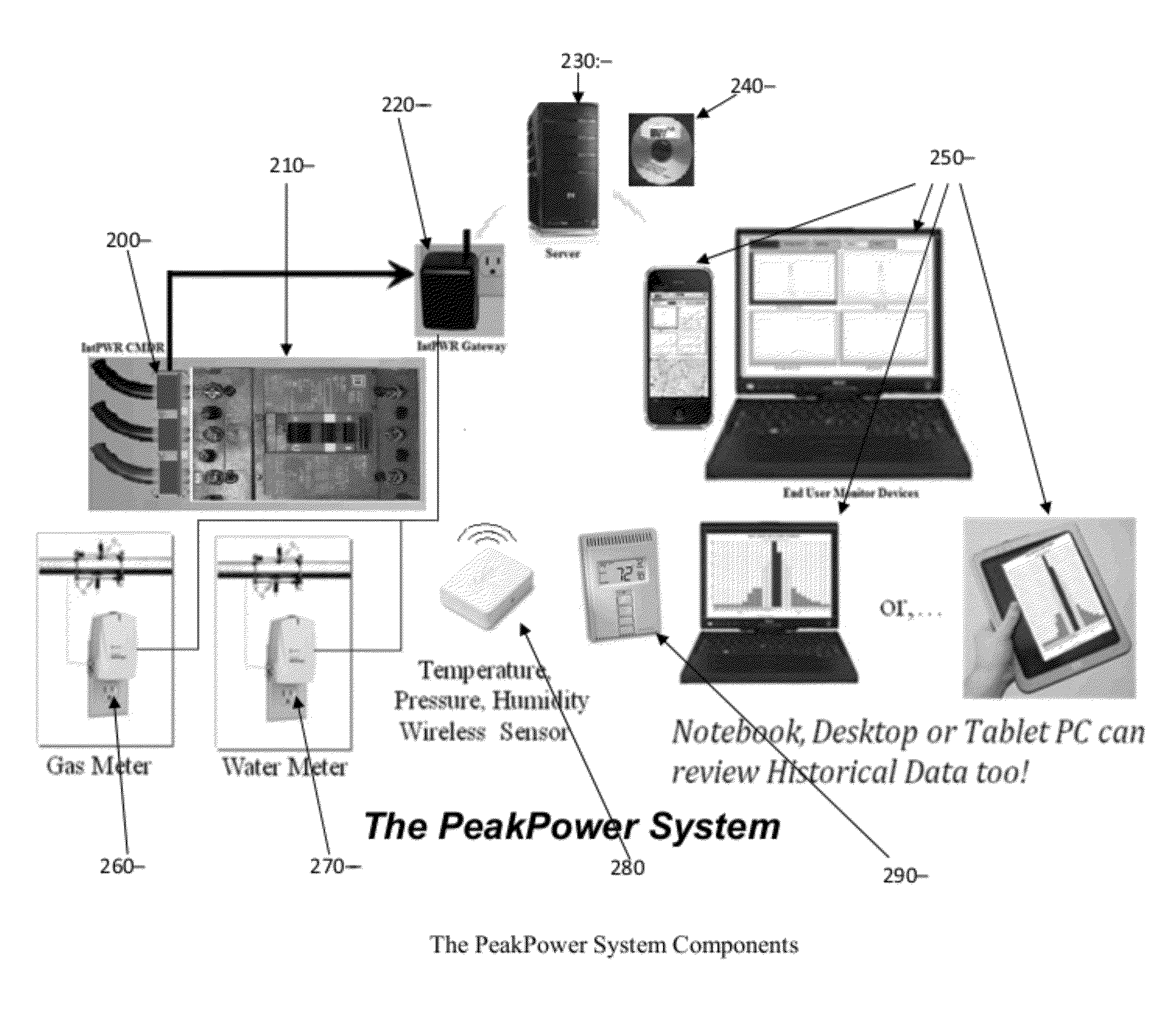

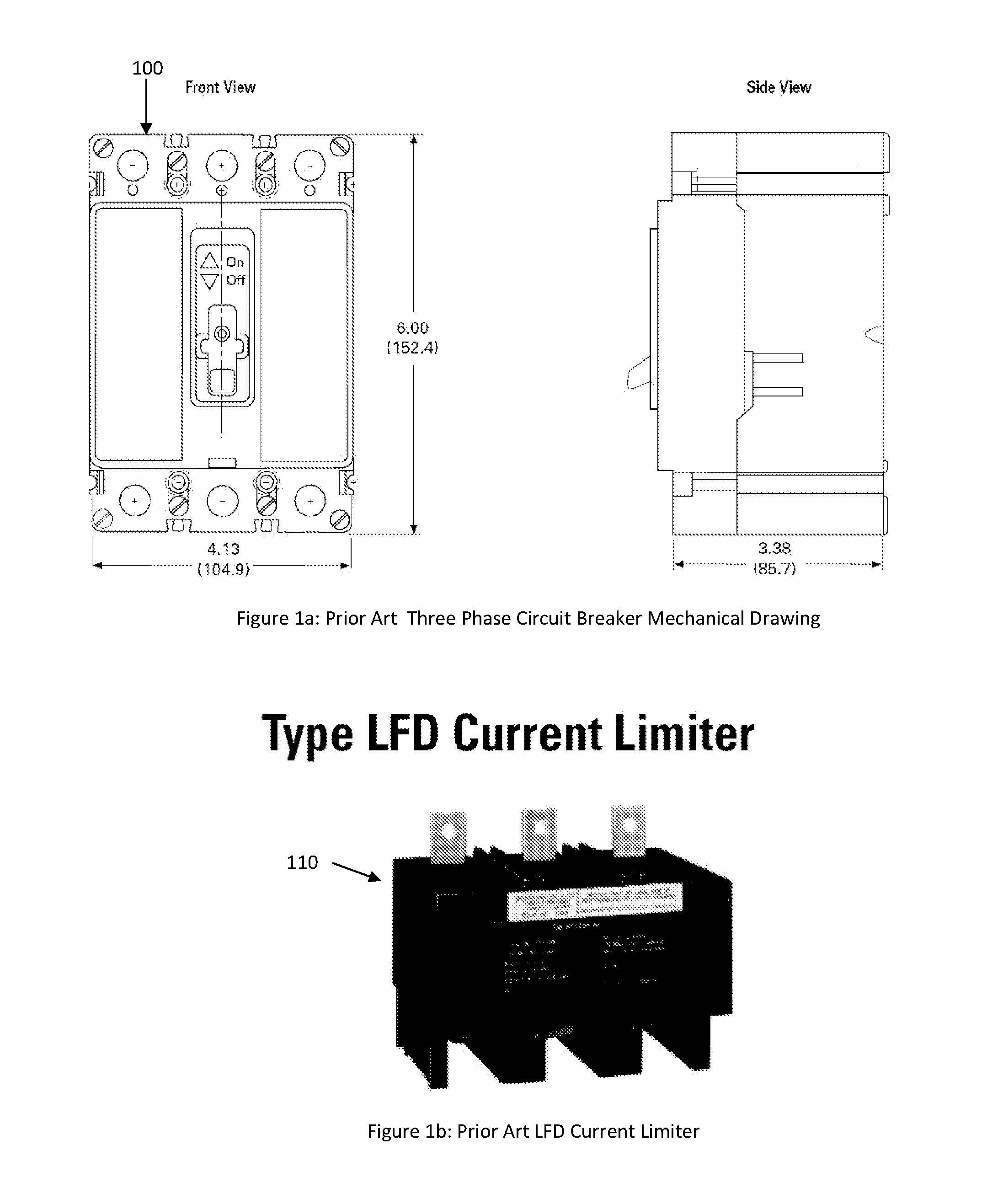

A PeakPower Energy Management and Control System having one or more roll-lock snap-on current transformer power monitoring devices, each to avoid interrupting power when installing current and / or power monitors. Each roll-lock snap-on current transformer power monitoring device may be snapped onto existing power wires inside a power panel or near equipment being monitored without disconnecting any wires or turning off power. Each roll-lock snap-on current transformer power monitoring device may be utilized in standalone mode as well as within a PeakPower Energy Management and Control System in accordance with disclosed embodiments. Each roll-lock snap-on current transformer power monitoring device may communicate via the power lines (Power Line Controller) or communicate via wireless using an integrated microprocessor based RF transceiver.

Owner:ENSITE POWER INC

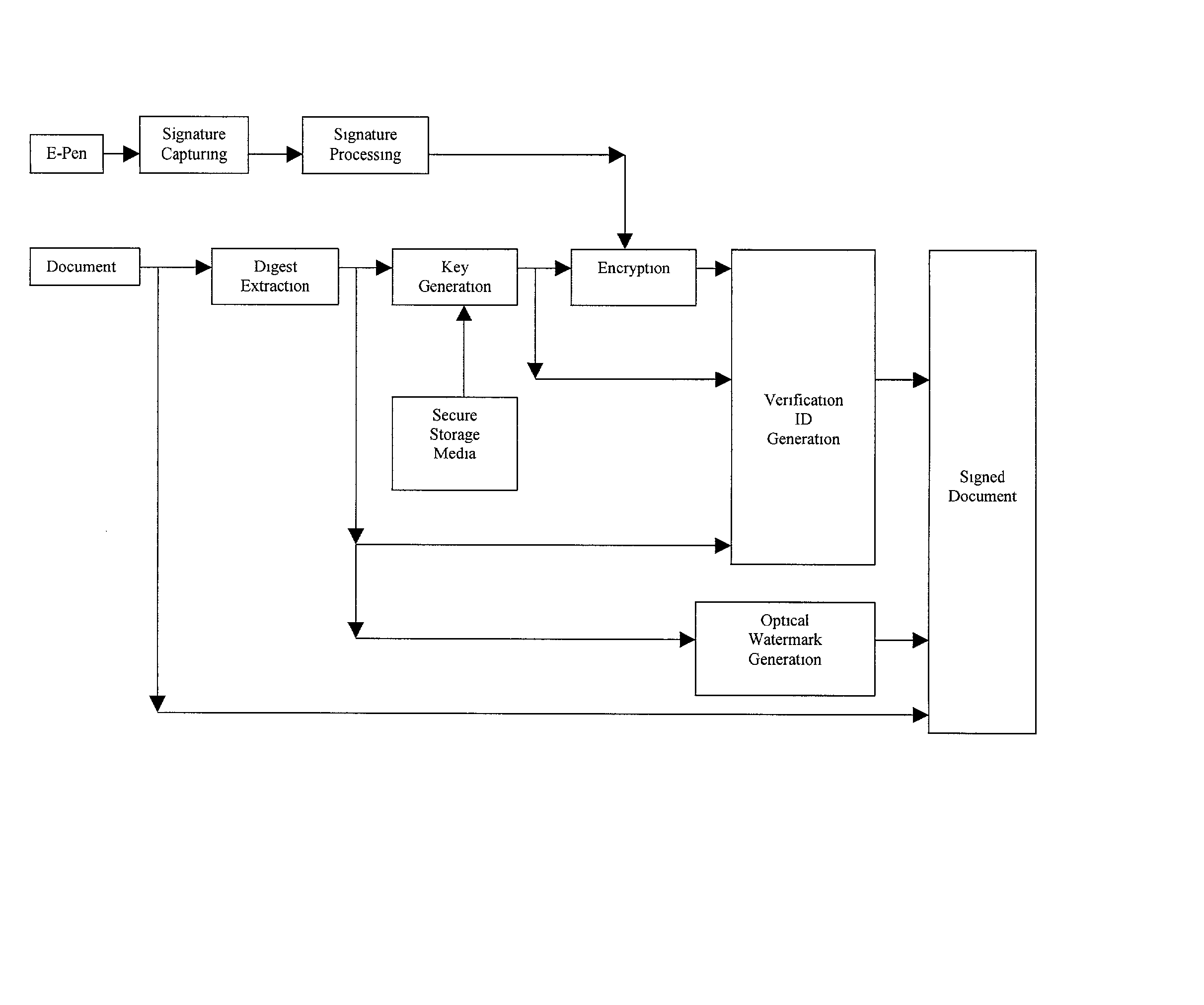

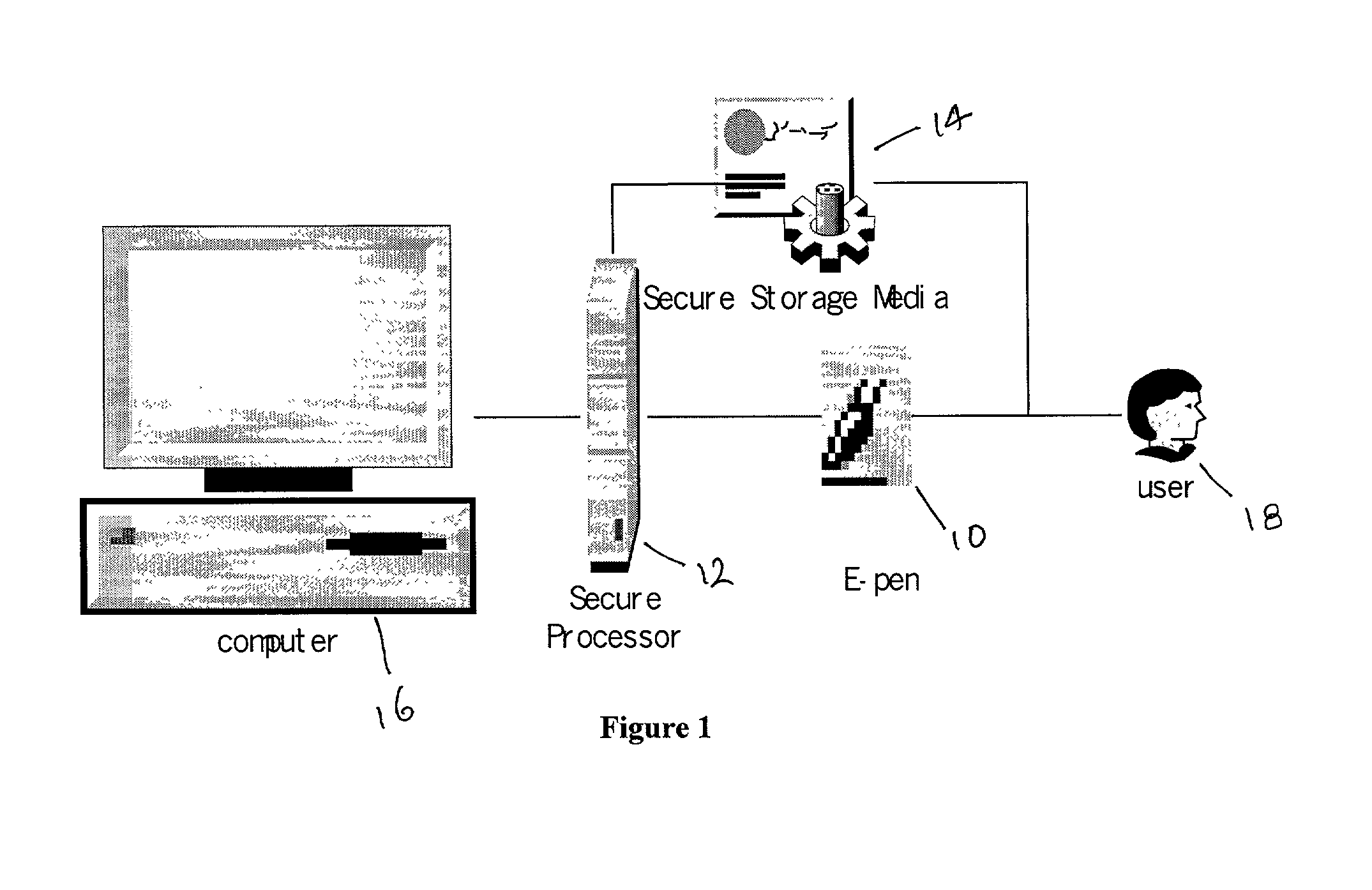

Electronic signing of documents

A method for a person to sign a document (as defined herein) by use of an electronic pen (as defined herein), including the steps of capturing a hand signature (as defined herein) of the person; verifying the person's identity; generating a verification ID; then attaching the hand signature, the verification ID and an optical watermark to the document to complete the document signing process. Also disclosed is a method for generating a validated hand signature (as defined herein) to a document including the steps of signing the document using an e-pen (as defined herein); creating a digest of the document; encrypting the hand signature within the electronic pen; generating a verification ID; incorporating the verification ID into the document; and integrating the digest into the document.

Owner:TRUSTCOPY PTE

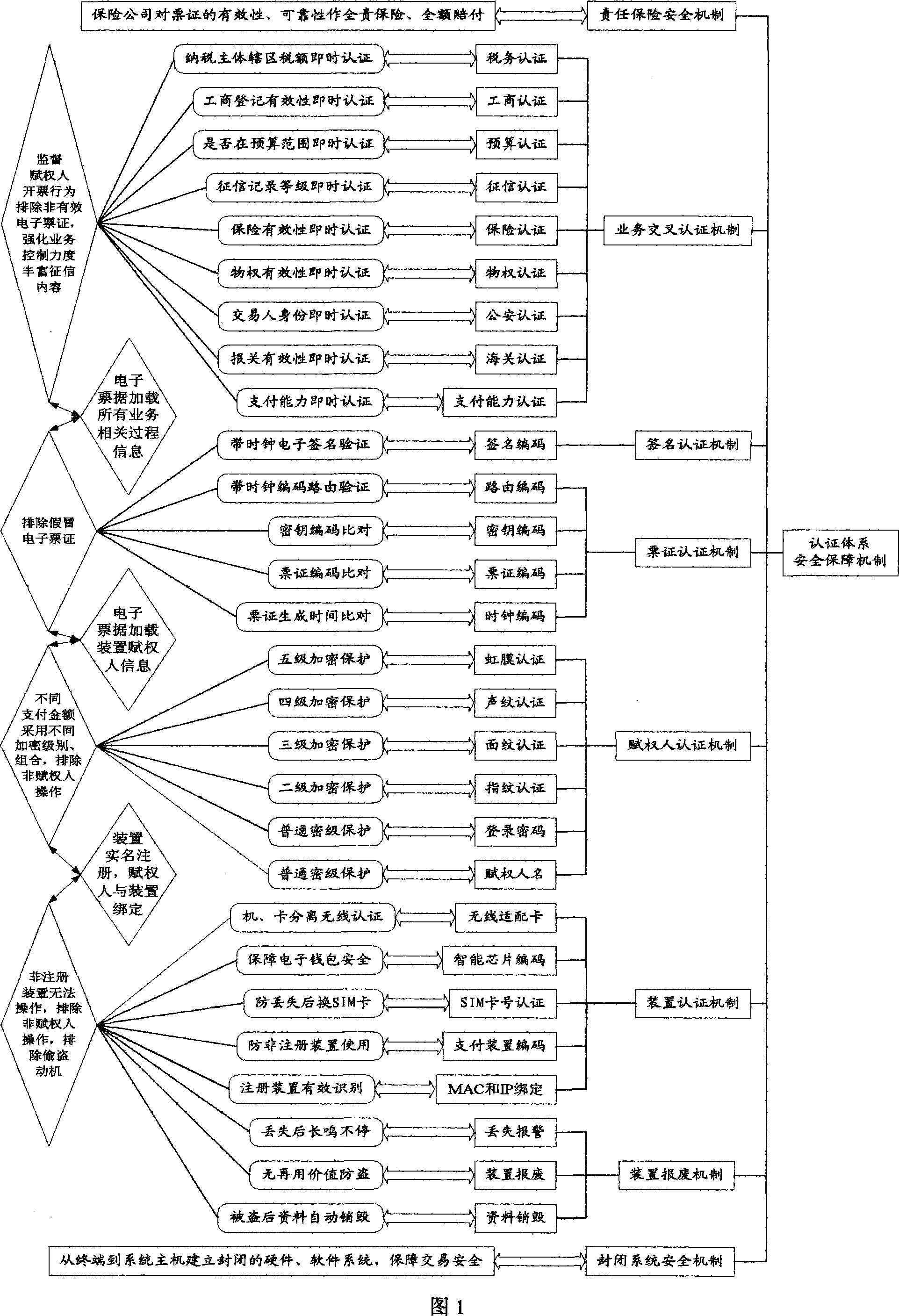

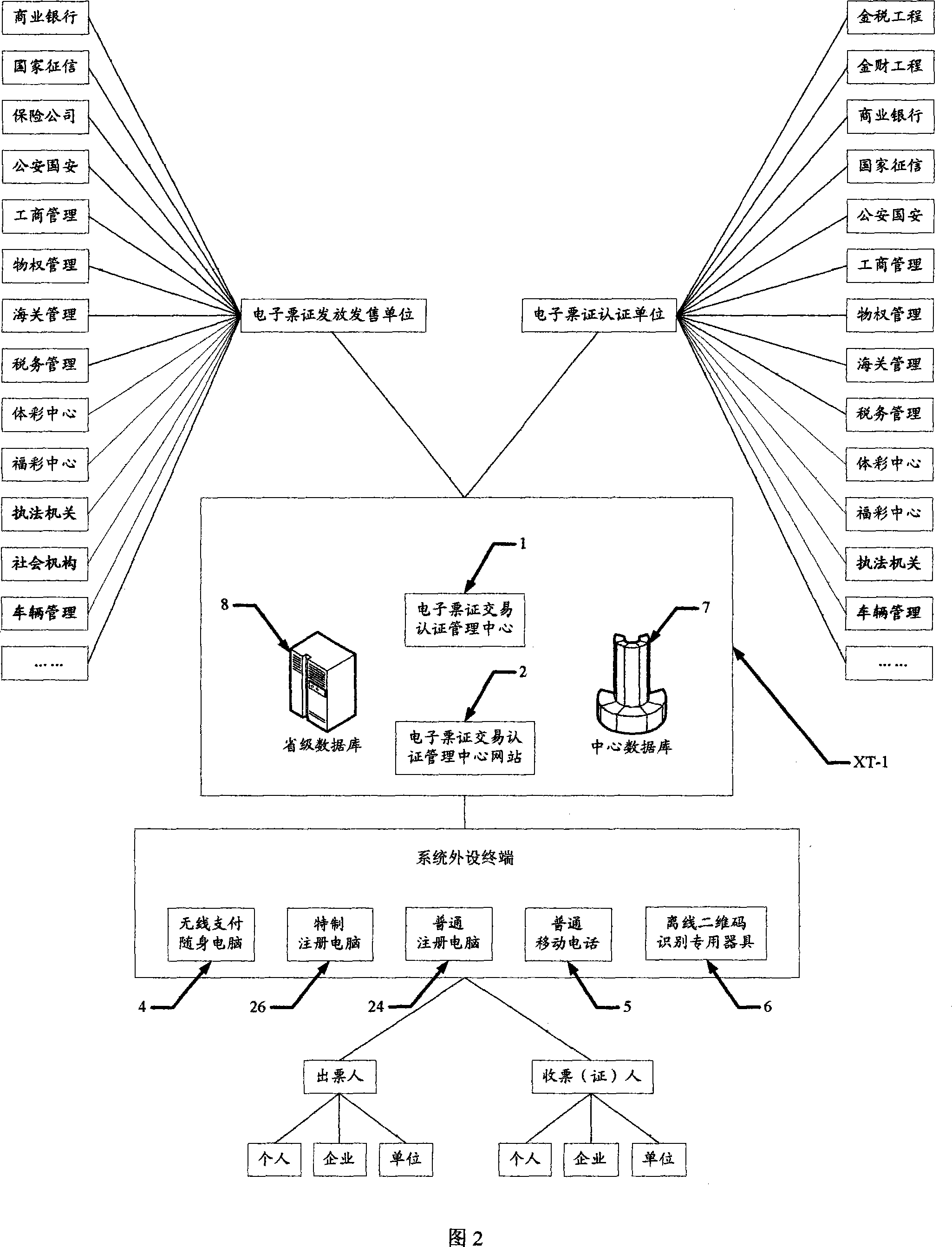

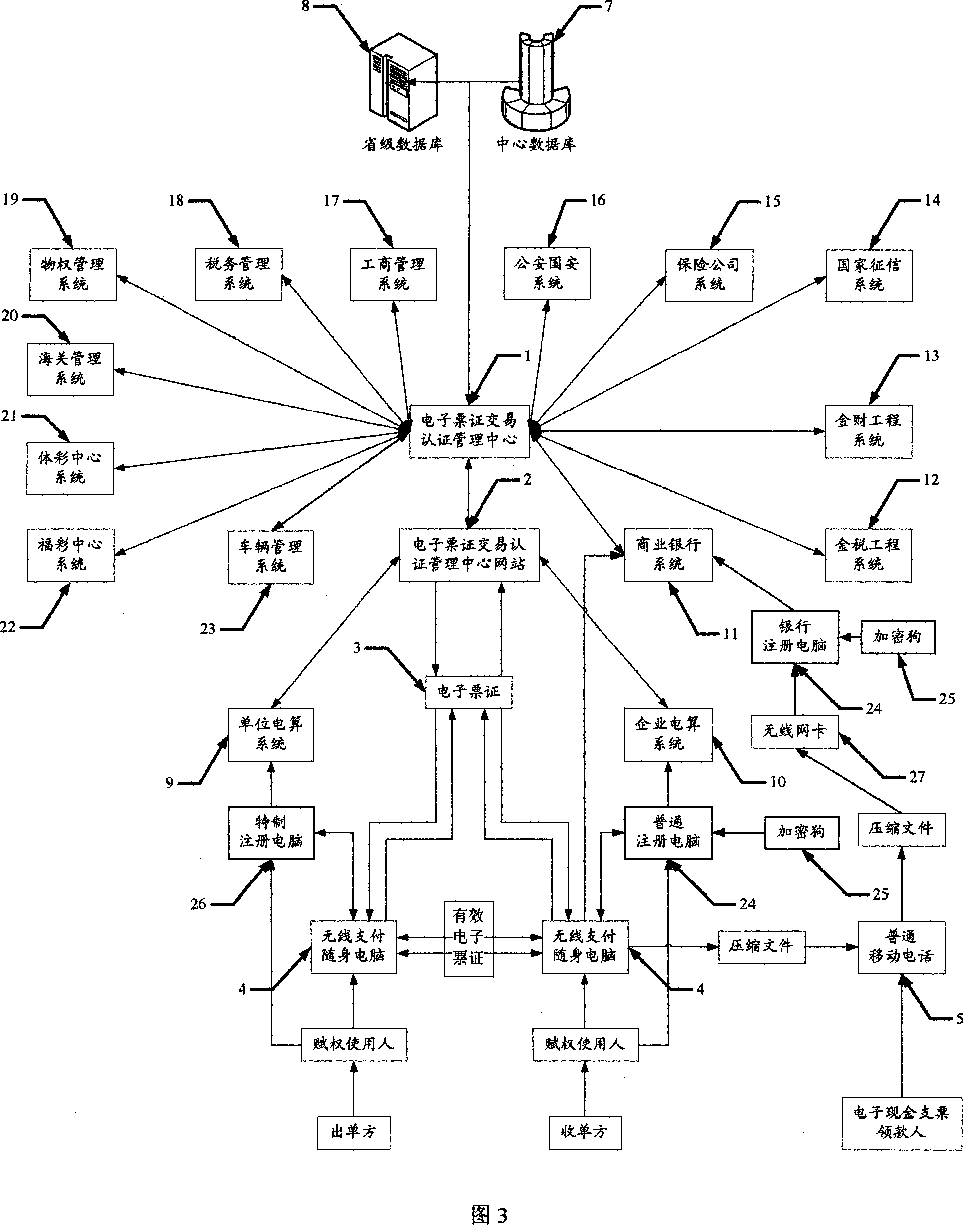

Method for managing electronic ticket trade certification its carrier structure, system and terminal

InactiveCN101075316APrevent forgeryPrevent tamperingAcutation objectsFinanceComputer scienceManagement system

A certification-managing method of electronic ticket transaction includes setting up certification-management center of electronic ticket transaction; connecting said center to fax office, financial office, commercial bank, public security, etc; registering user with real name on terminal; purchasing and downloading electronic ticket; finalizing ticket filling, certifying, electronic signing and locking; exchanging ticket through transaction-certification network station of ticket for realizing integrated certification in order to ensure truth of ticket.

Owner:SICHUAN ZHENGDAOTIANHE INFORMATION TECH

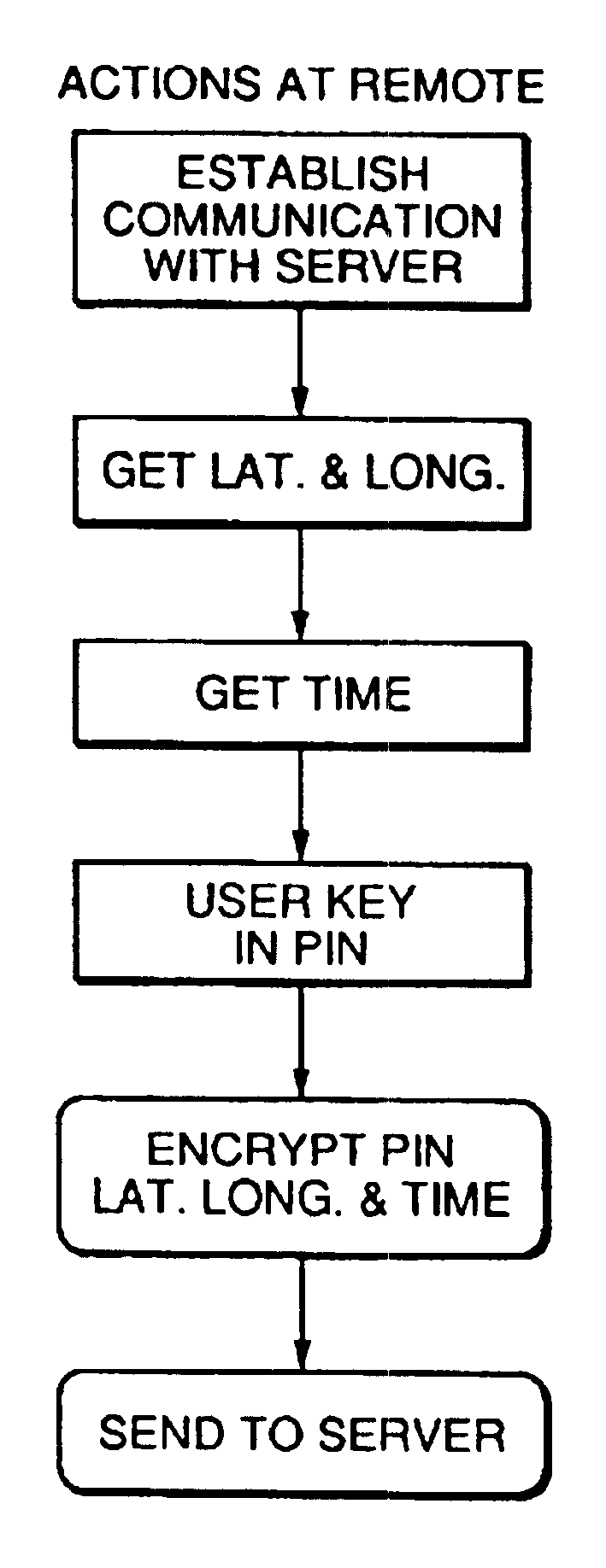

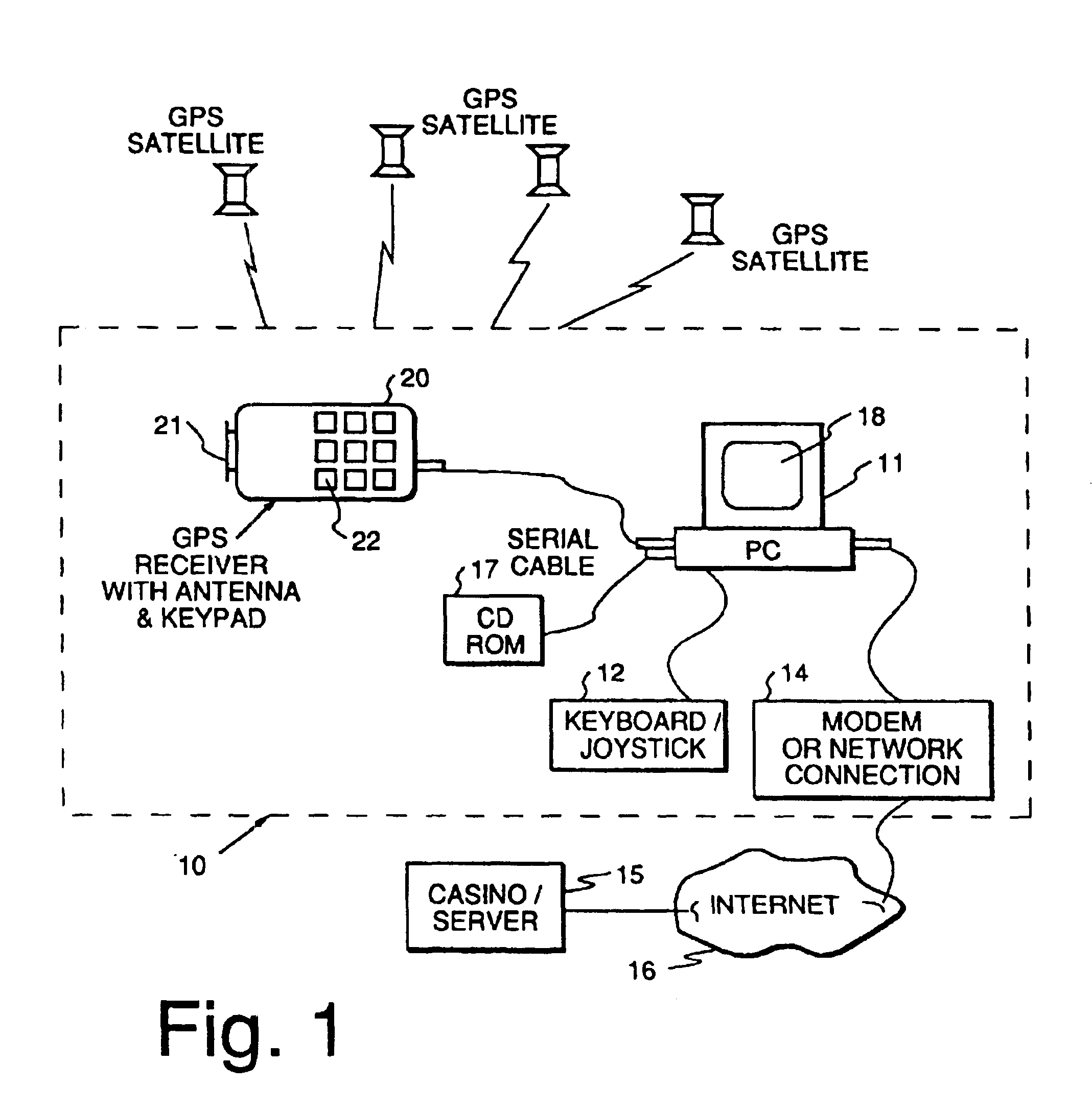

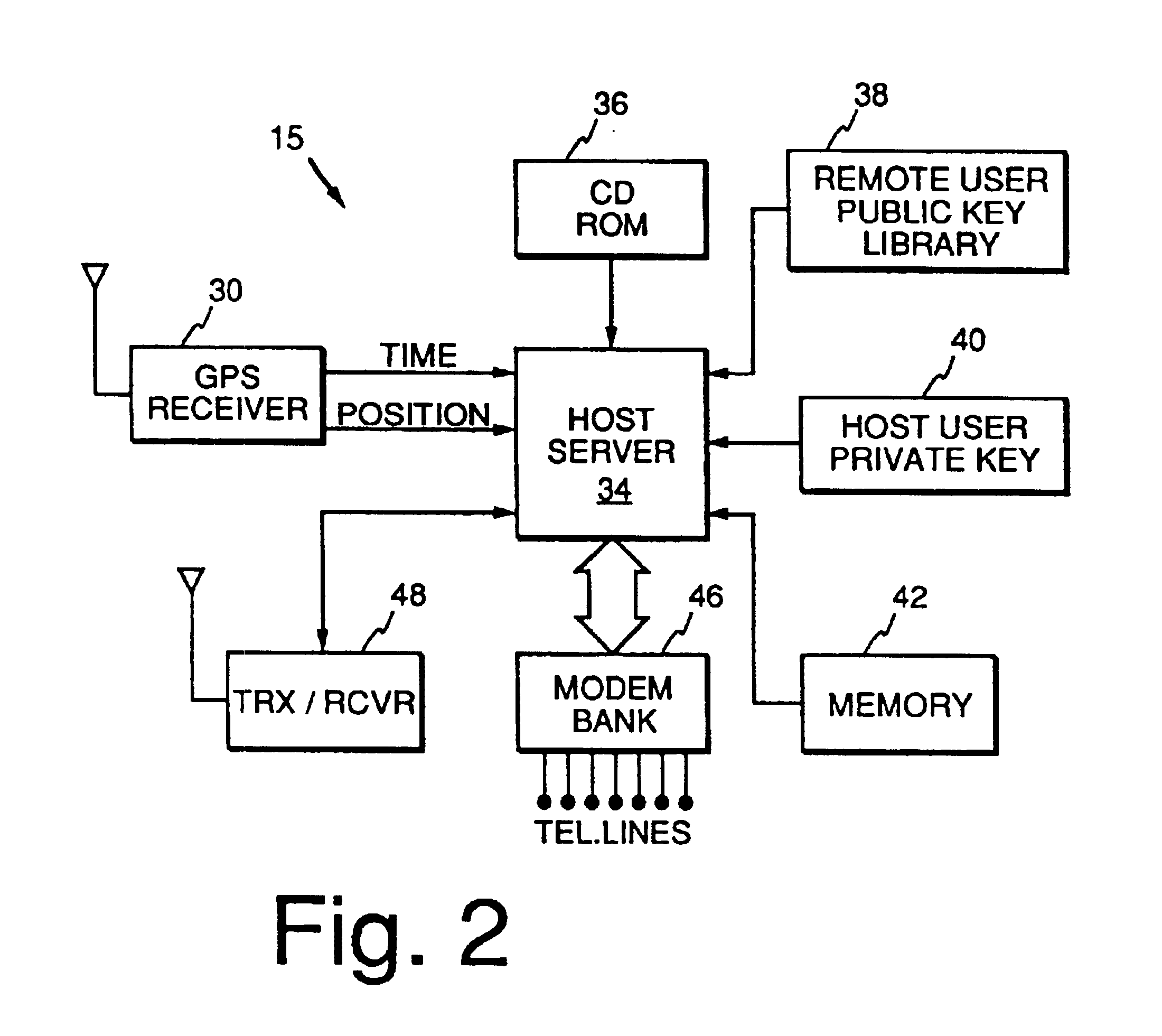

Method and apparatus using geographical position and universal time determination means to provide authenticated, secure, on-line communication between remote gaming locations

InactiveUSRE39644E1Facilitates denialAccurately determineSecret communicationApparatus for meter-controlled dispensingGeolocationThe Internet

Method and apparatus for providing authenticated, secure, on-line communication between remote locations including a user terminal adapted to enable a player in one location to remotely communicate via a communications medium such as the Internet with a gaming host in another location. Location of the remote user terminal, the host server and universal time are determined using means for accessing signals generated by geostationary navigational transmitters, such as in the global positioning satellite (GPS) system. Player authentication (identity verification) is determined by use of a personal identification number (PIN) and an electronic signature verification service. Security of communication is accomplished through use of a public-key / private-key encryption system. The remote user terminal may be comprised of one or more discreet components adapted to be used with a laptop or desktop personal computer (PC), or may be embodied in a stand alone or self-contained single unit that is portable and communicates via radio waves, telephone lines or the Internet to a host server.

Owner:IGT

Banking system controlled responsive to data bearing records

InactiveUS20090173781A1Reduce in quantityComplete banking machinesFinanceWireless transmissionCheque

A banking system operates to allocate funds in accounts in response to data bearing records in the form of paper financial checks. A mobile phone has a camera and a programmable memory. The memory stores phone user data, including a bank account number and an electronic signature. The camera can be used to capture an image of a paper check which has the phone user as the payee. The phone can wirelessly transmit the account number, the electronic signature, and the check image to a bank deposit system. The system can store the check image and the electronic signature in correlated relation in a deposit transaction record. The system can cause the phone user's bank account to be credited a cash value corresponding to the check value. Confirmation of the check deposit can be transmitted to the user's phone.

Owner:DIEBOLD SELF SERVICE SYST DIV OF DIEBOLD NIXDORF INC

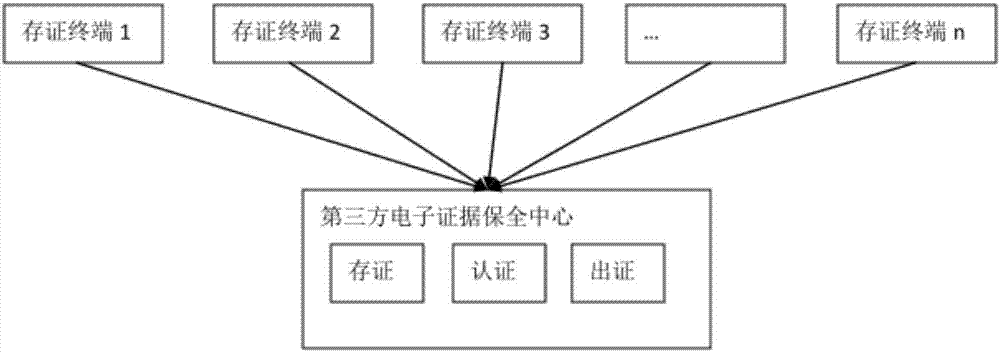

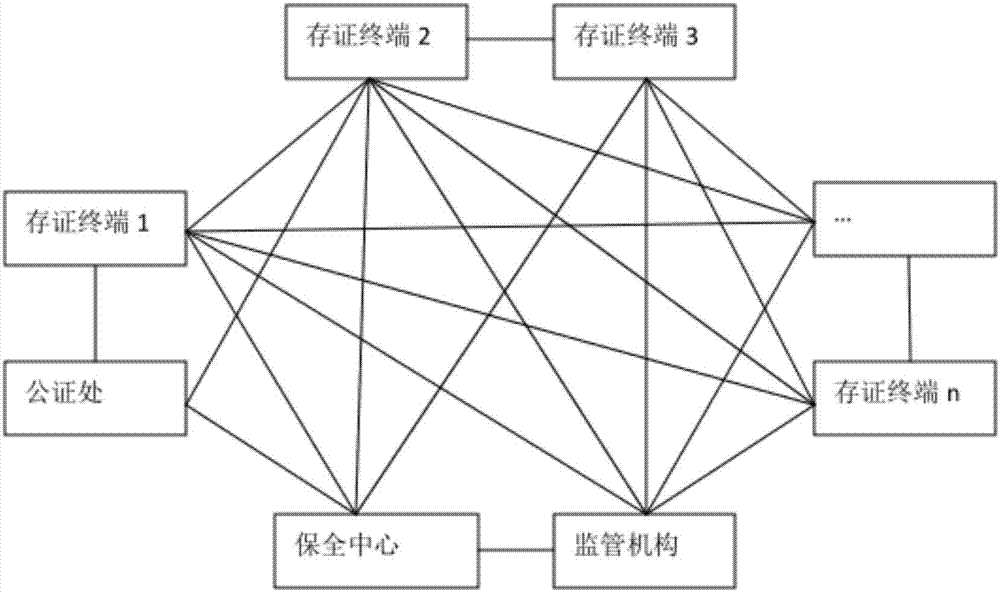

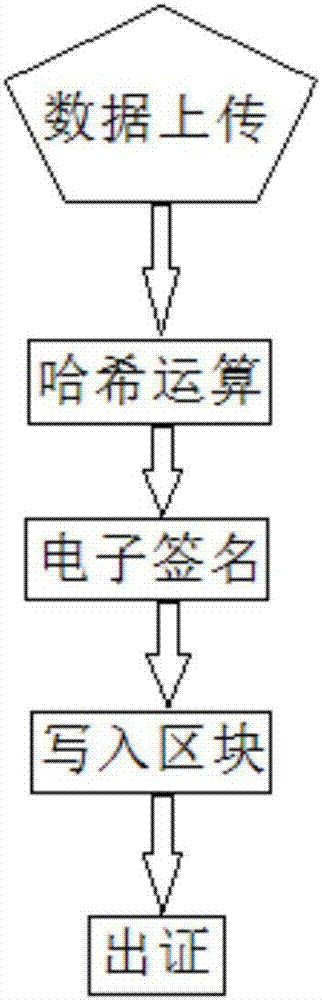

Electronic evidence preservation system and method based on block chain technology

InactiveCN107888375ASolve pain pointsFix bugsEncryption apparatus with shift registers/memoriesDigital data protectionOriginal dataComputer module

The invention discloses an electronic evidence preservation system and method based on the block chain technology. The preservation system comprises an evidence storage terminal and a block chain network. The evidence storage terminal comprises a hash operation module and an electronic signature module. The electronic data are uploaded to the evidence storage terminal, the evidence storage terminal performs hash operation on the uploaded electronic data to generate unique feature data of a fixed length of original data; then private key signature is performed on the generated data by using theasymmetric encryption technology, and the generated data are sent to the block chain network; and the block chain network performs primary consensus on the uploaded data and packs the uploaded data into blocks, and synchronously sends the blocks to nodes in the network for distributed storage. By establishing an evidence storage alliance by using the block chain technology, the electronic evidence preservation system has the characteristics of digitalized encryption, centralized grading, anti-tampering, data zero loss and so on. Each node in the block chain can preserve a complete block chaindata copy and witness the chain status of the blocks, so that the centralization risk can be effectively avoided.

Owner:SHENZHEN XIEWANG TECH CO LTD

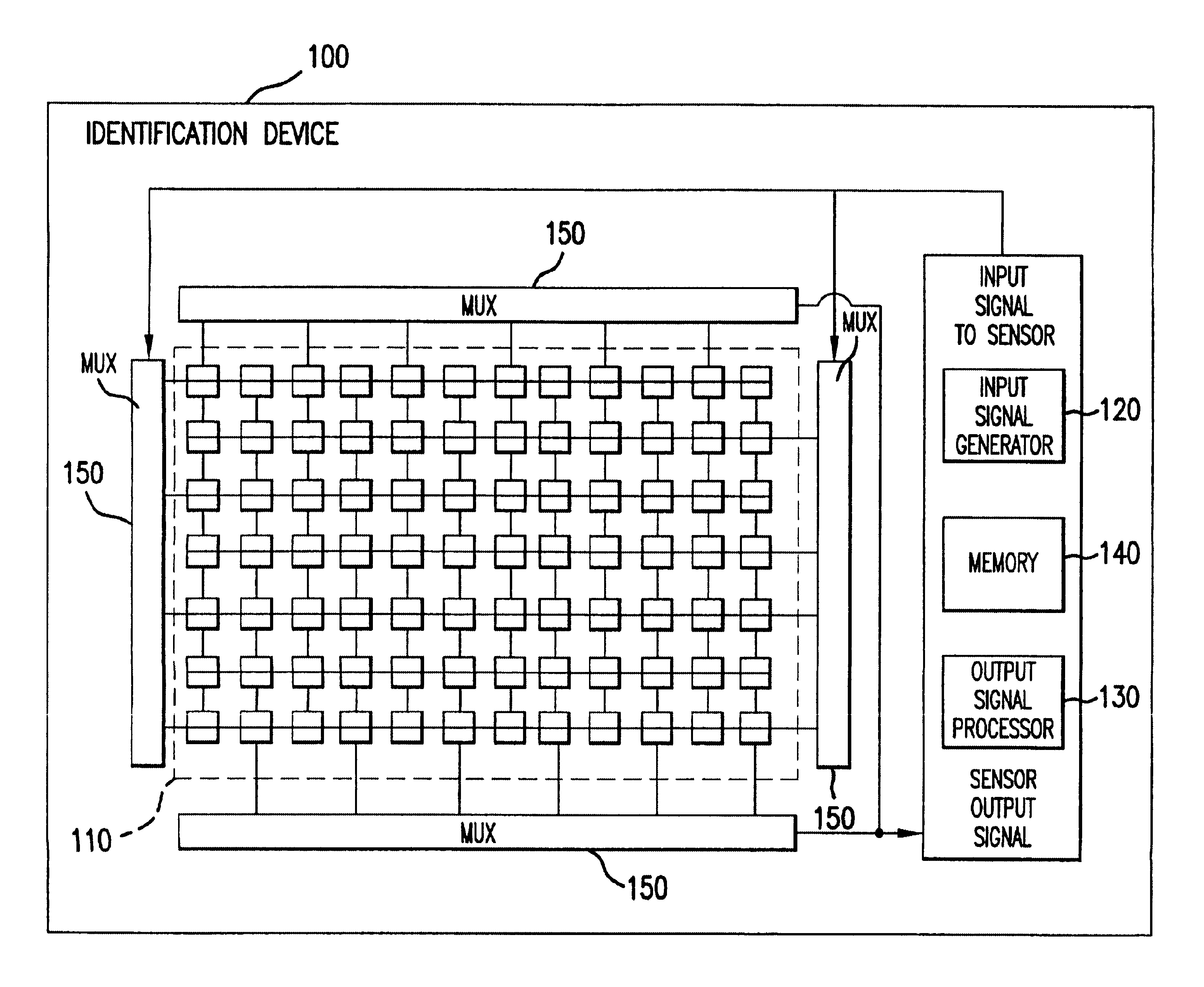

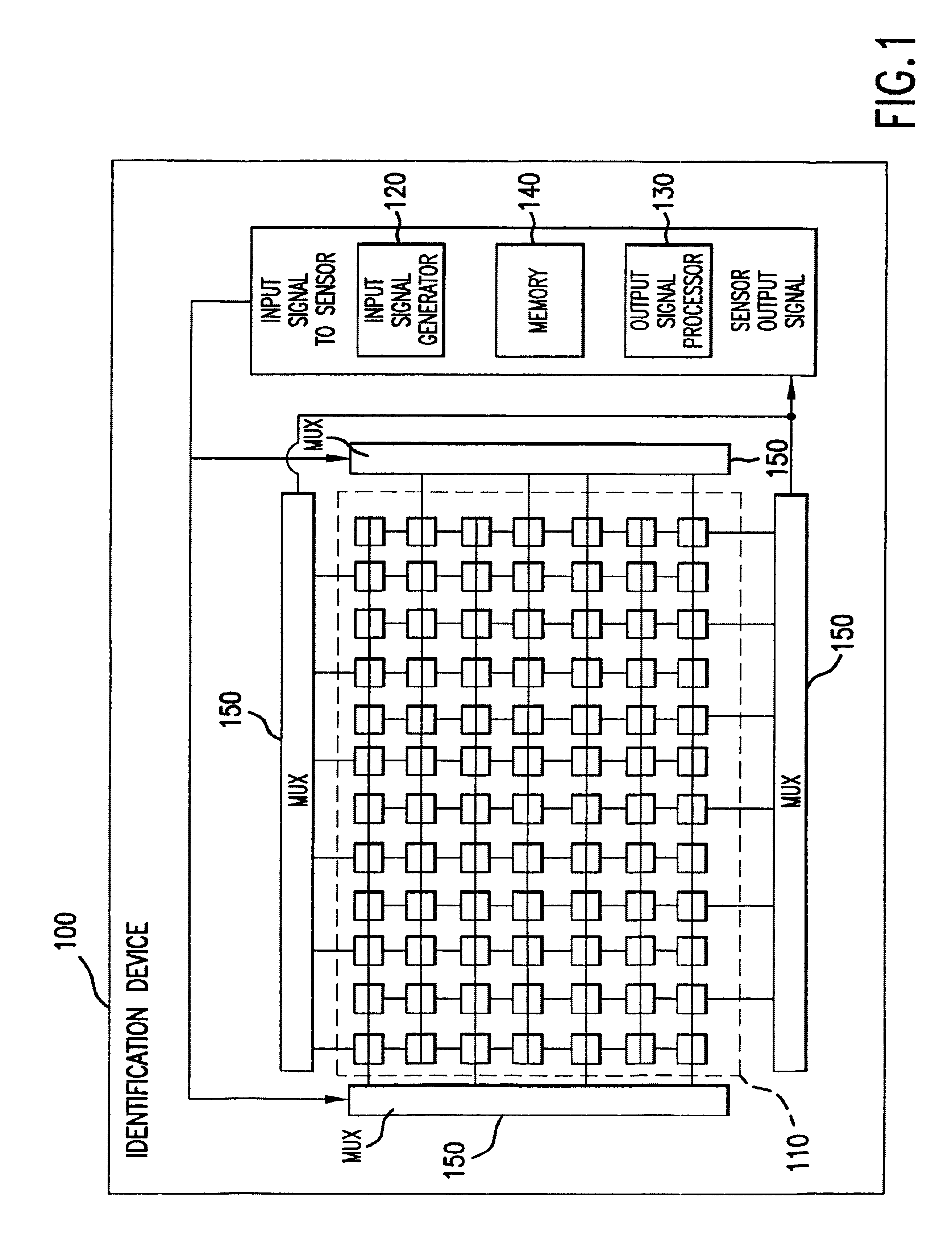

Piezoelectric identification device and applications thereof

InactiveUS6720712B2Piezoelectric/electrostriction/magnetostriction machinesPerson identificationBiometric dataEngineering

An identification device having a piezoelectric sensor array is used to obtain biometric data. Multiplexers are switched to control the sensor. The device has several operating modes for obtaining a variety of biometric data, including an impedance detection mode, a voltage detection mode, an imaging mode, and a Doppler-shift detection mode. The presence of a fingerprint on the sensor can be used to turn-on the device. The device is capable of capturing a fingerprint, forming a three-dimensional map of a finger bone, and / or determining the direction and speed of arteriole and / or capillary blood flow in a finger. A single pixel or a group of pixels can be detected and readout to a memory. The device can be used as an electronic signature device. The device can operate as part of a personal area network, using a public service layer according to the invention.

Owner:HID GLOBAL CORP +1

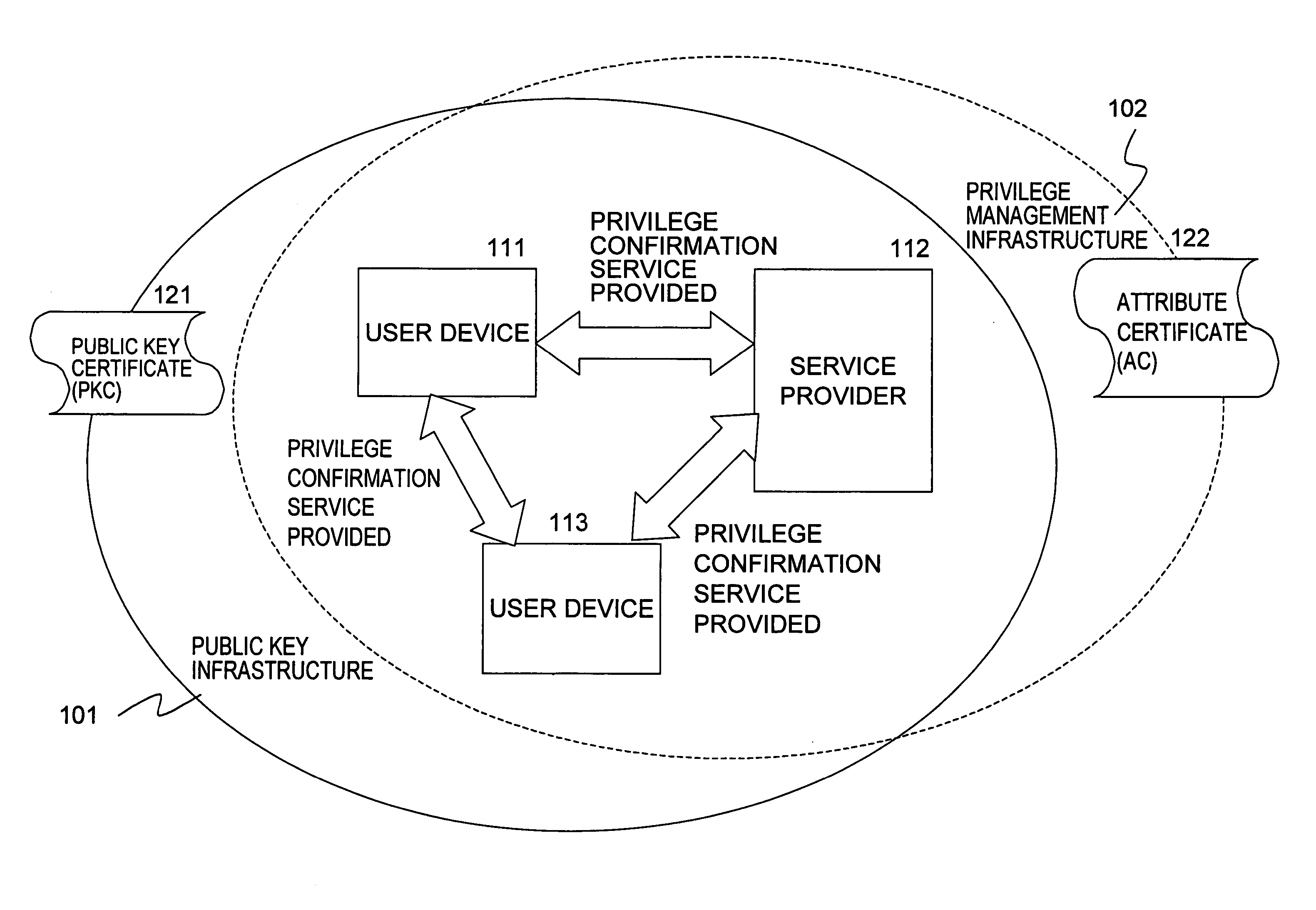

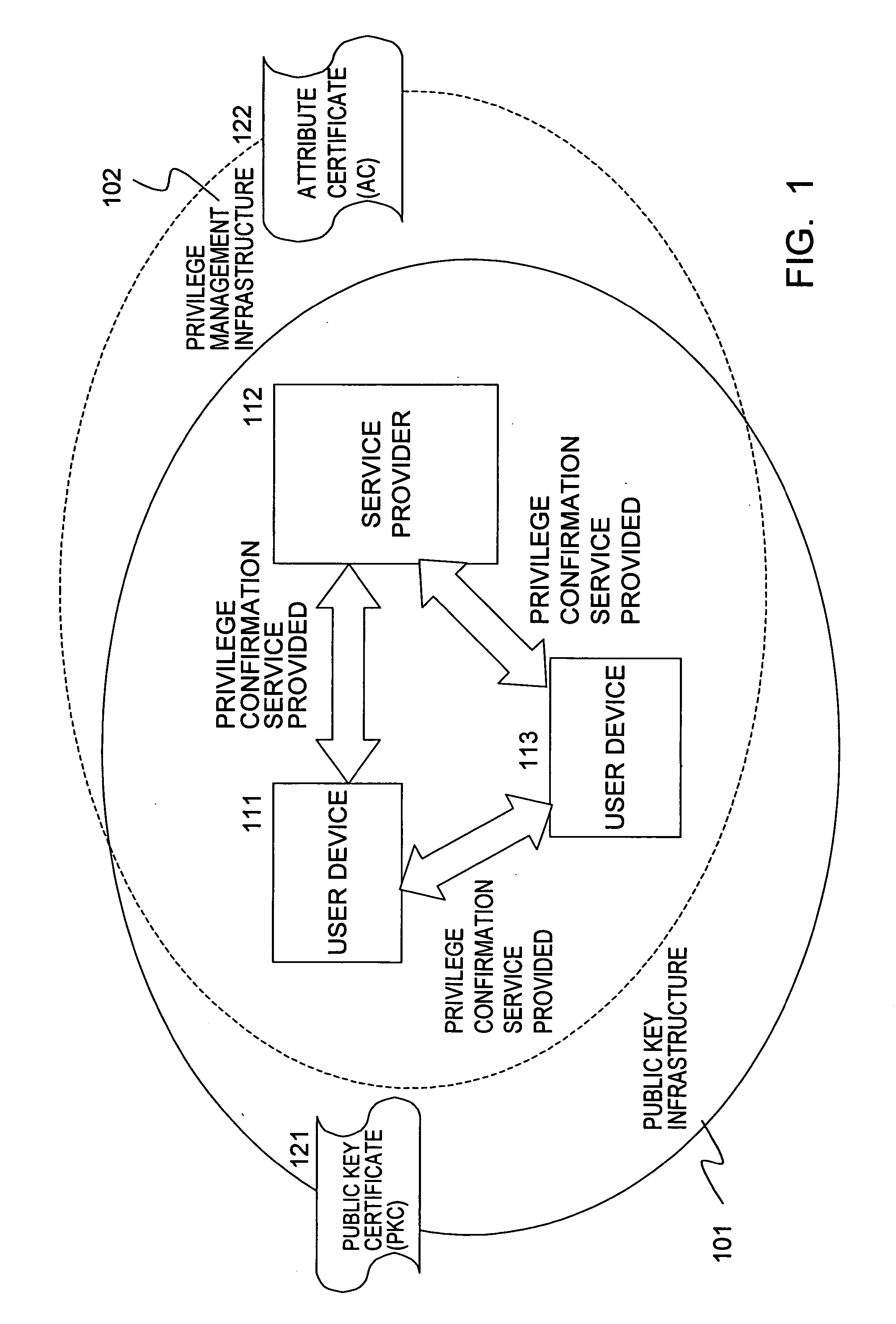

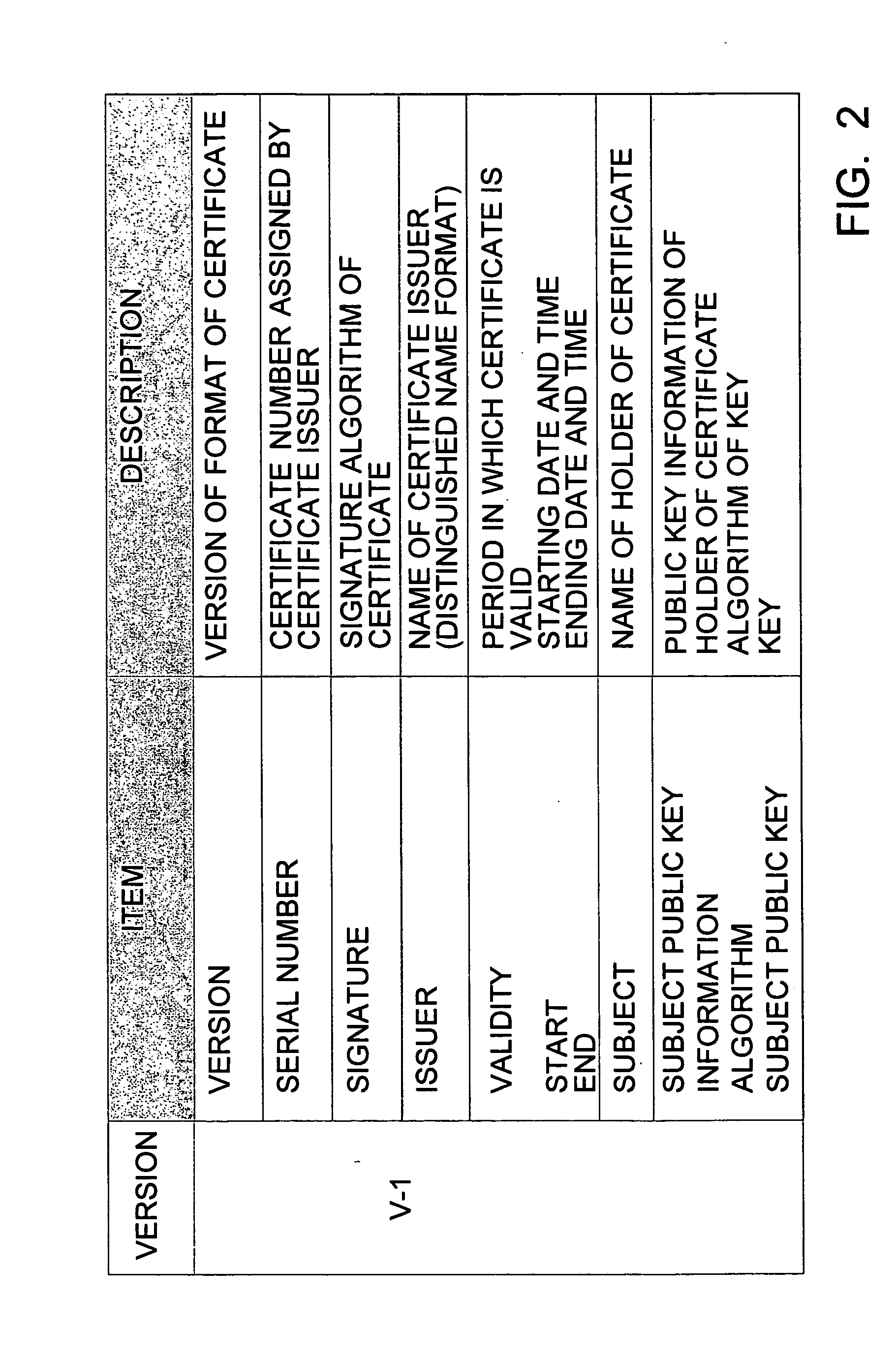

Data processing system, data processing device, data processing method, and computer program

InactiveUS20060106836A1Improve variationEliminating accessDigital data processing detailsUser identity/authority verificationData processing systemUser device

A privilege management system enabling effective privilege management, such as confirmation processing of service receiving privileges and so forth, is realized. A group attribute certificate which has, as stored information, group identification information corresponding to a group which is a set of certain devices or certain users, and also has affixed an electronic signature of an issuer, is issued to a service reception entity, and verification is performed by means of signature verification for of the group attribute certificate presented from the user device regarding whether or not there has been tampering, screening is performed regarding whether or not this is a service-permitted group based on group identification information stored in the group attribute certificate by using a group information database, and determination is made regarding whether or not service can be provided, based on the screening. Centralized privilege confirmation corresponding to various user sets or device sets can be made, so management of individual privilege information can be omitted, thereby enabling effective privilege management.

Owner:SONY CORP

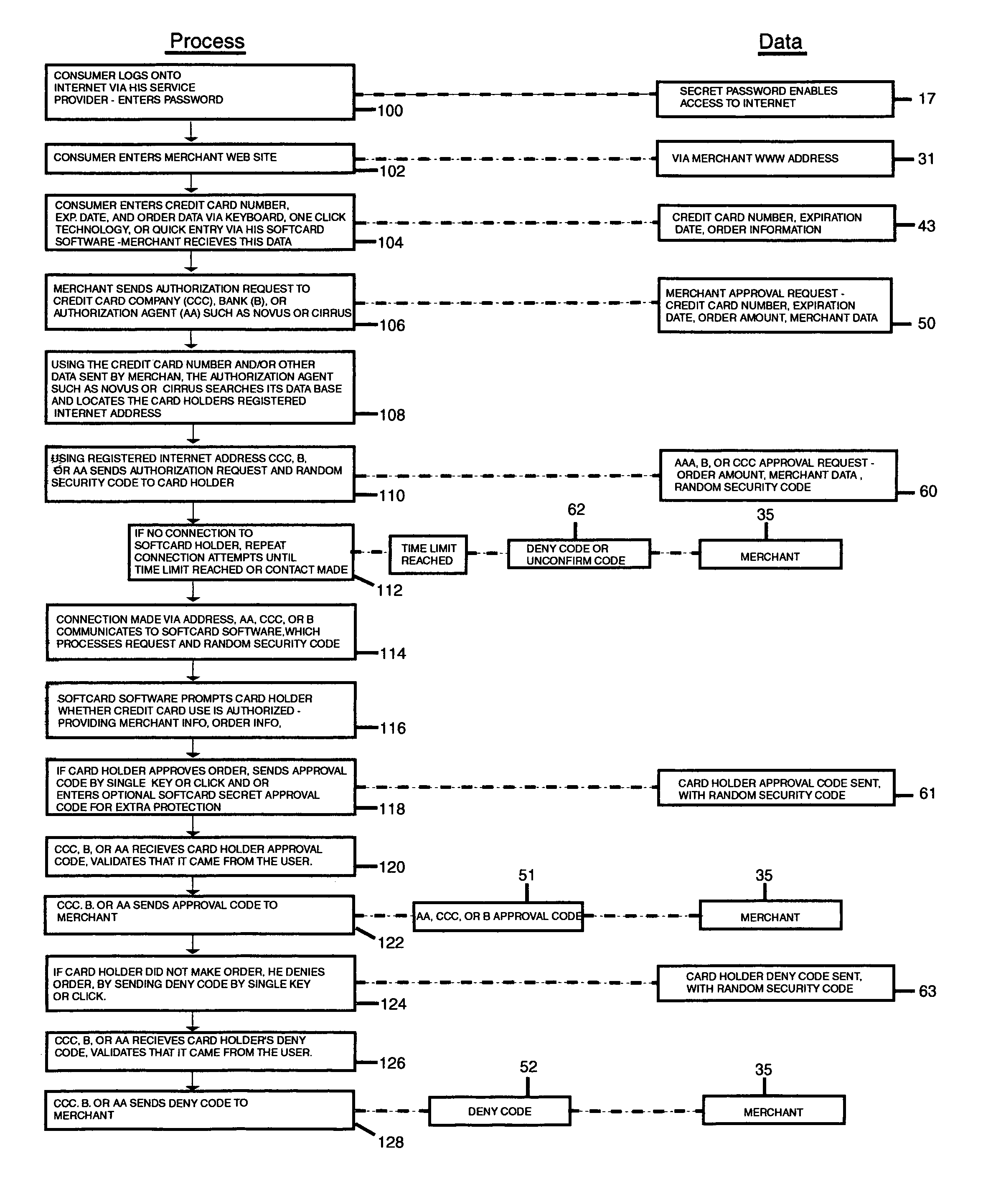

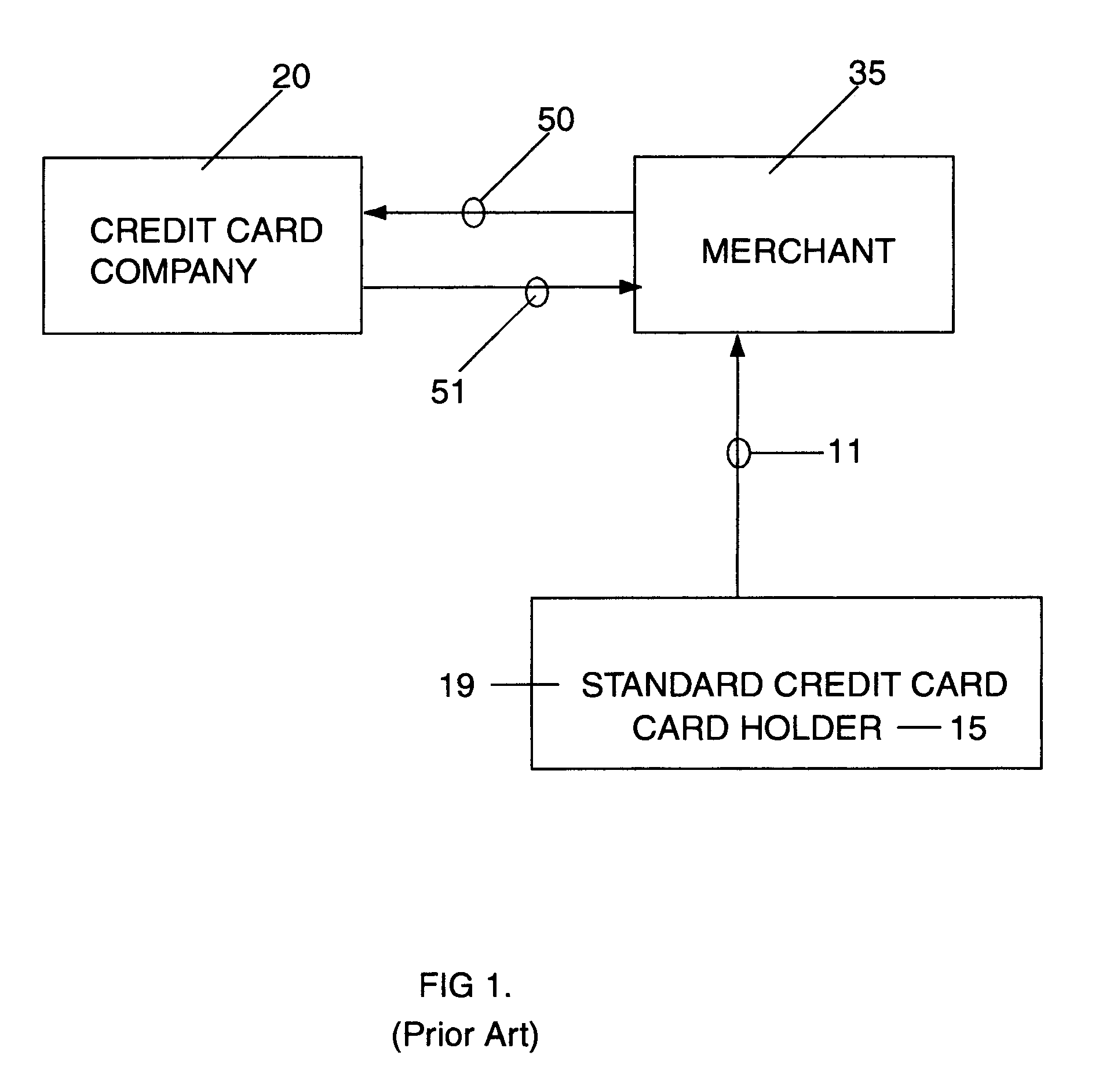

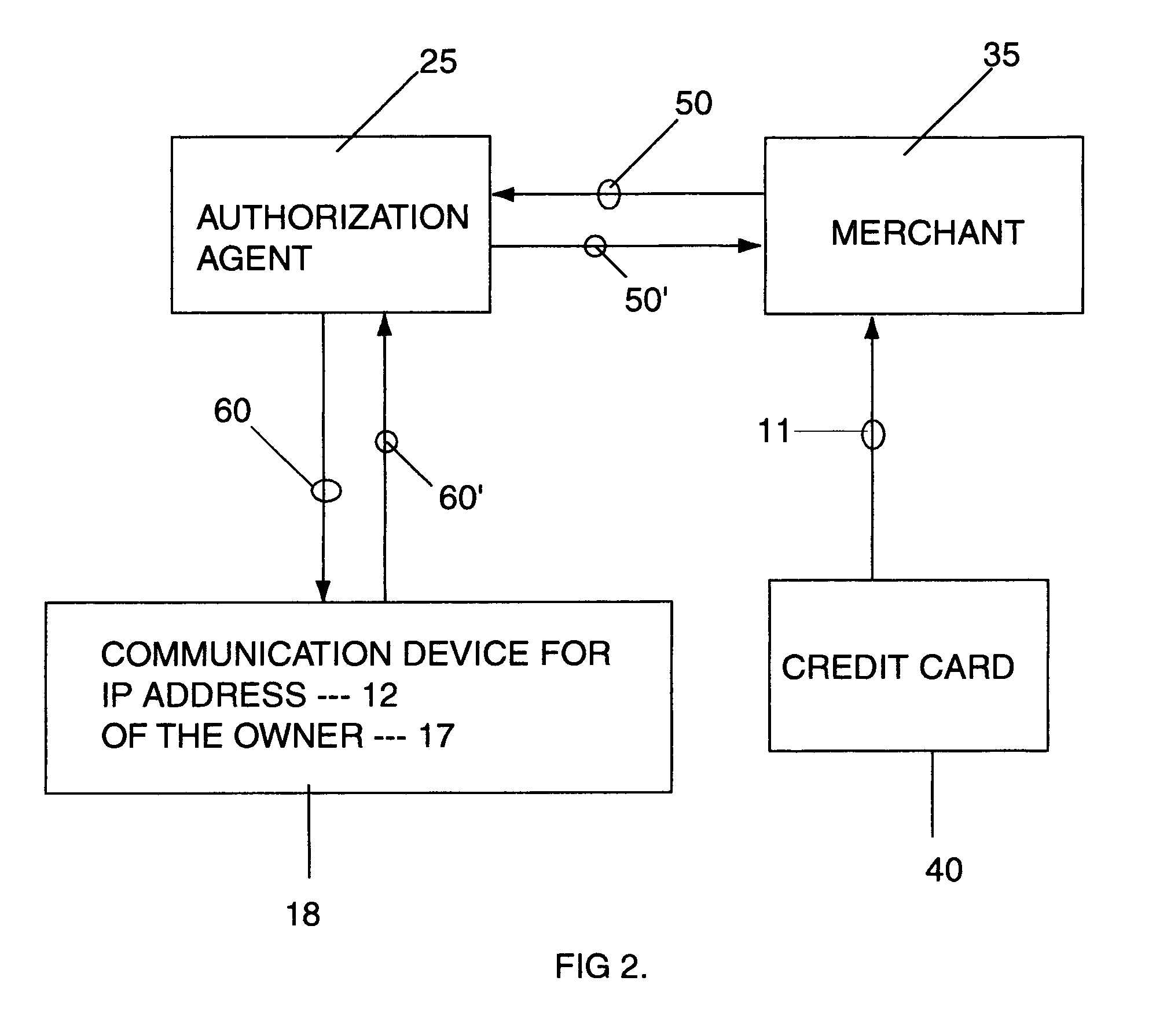

Dual transaction authorization system and method

A general feature of the present invention is to provide a dual authorizing system and method to prevent fraudulent use of credit cards and E-signature. To do so, a third party verifier is provided to ensure that the rightful owner of the credit card or E-signature approves of the transaction before the purchase is completed between the merchant and the credit card user. This is accomplished by linking the owner's Internet address or addresses or other communication device address to the credit card number, and storing this information with the third party verifier, such as an Authorization agent. Once the card is used to make a purchase, the Authorization agent is notified of the purchase. The Authorization agent then pulls the corresponding Internet address or communication address for the credit card number, then sends an approval request message to the owner at the owner's Internet address or communication device. This way, only the owner who had previously registered the credit card number with the Authorization agent is notified of the pending purchase and can approve or deny the purchase and, thereby preventing unauthorized user from making purchase using the owner's credit card.

Owner:KLOOR HARRY THOMAS

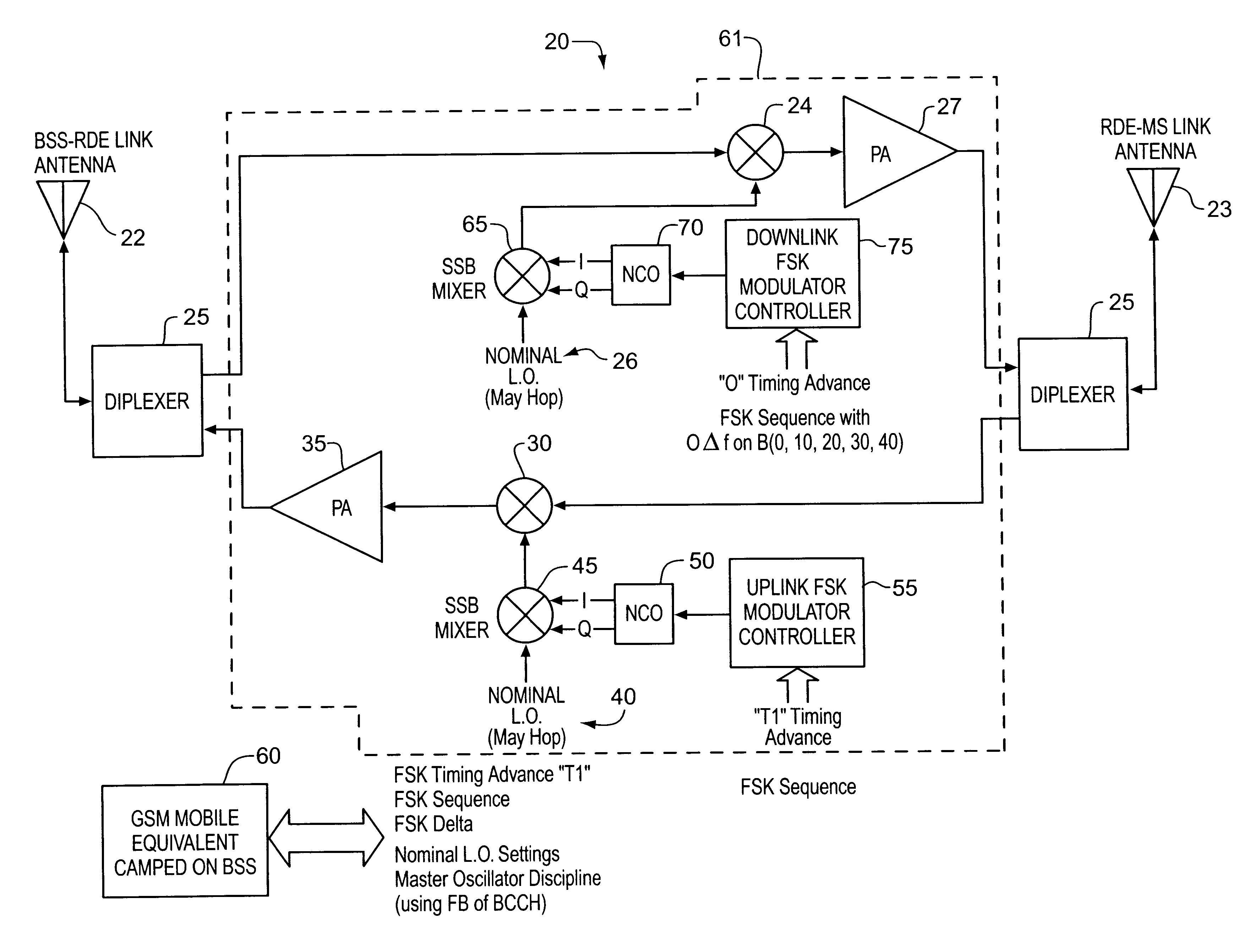

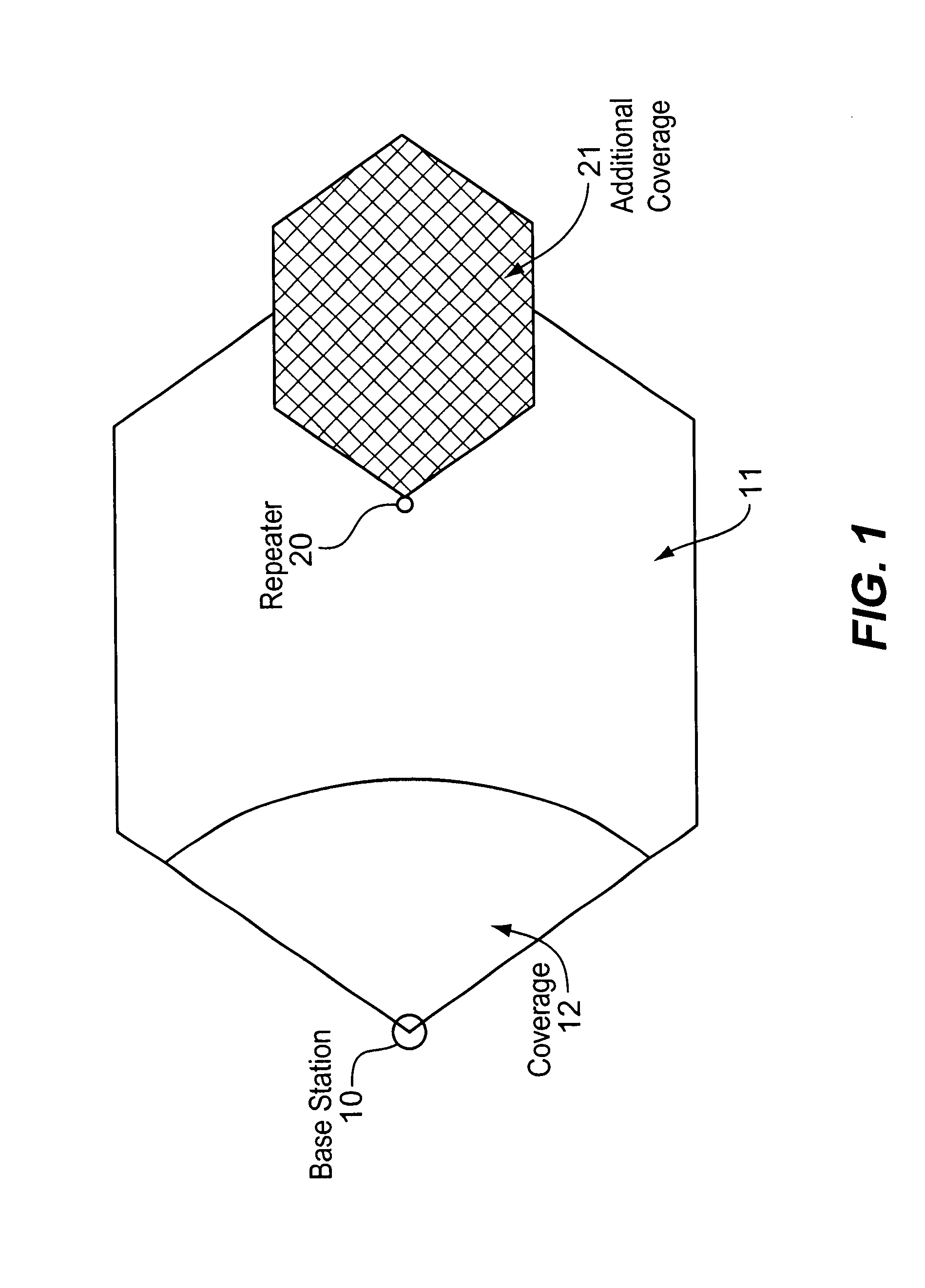

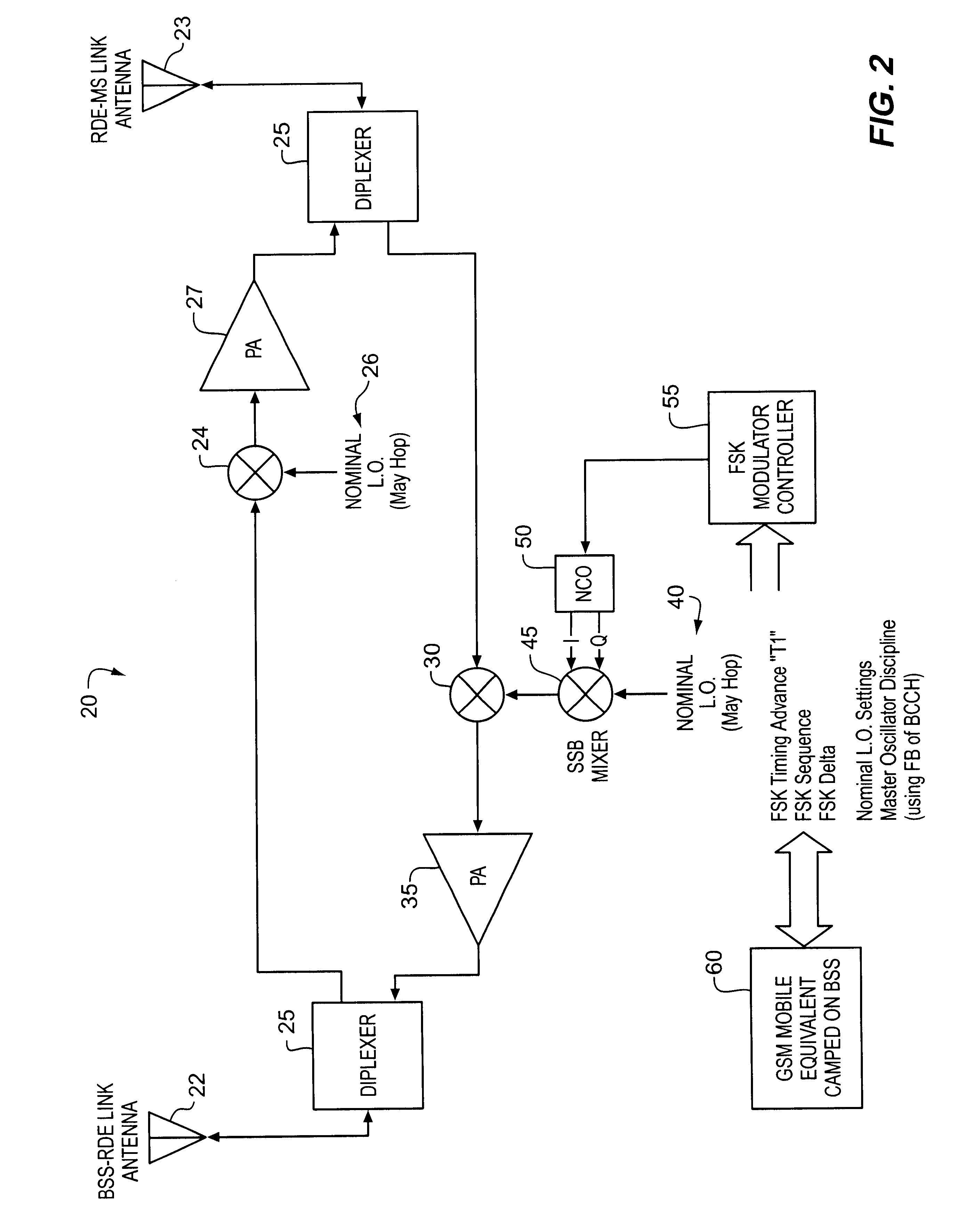

RF signal repeater in mobile communications systems

A RF signal repeater system is added to a wireless communications network which increases user data rates at the periphery of the cellular coverage area by boosting the downlink (base station to mobile user) signal and uplink (mobile user to base station) signal. The RF signal repeater system includes a signal tagging means that adds a unique electronic signature to the repeated signal such that position determination errors due to a non-line of sight propagation path can be corrected. The repeated signal is received and processed with a location measurement unit to determine the time of arrival and to extract the signal tag of the repeated signal. The time of arrival measurement and recovered signal tag are then processed at a mobile location center to determine the true position of the transmitter.

Owner:APPLE INC

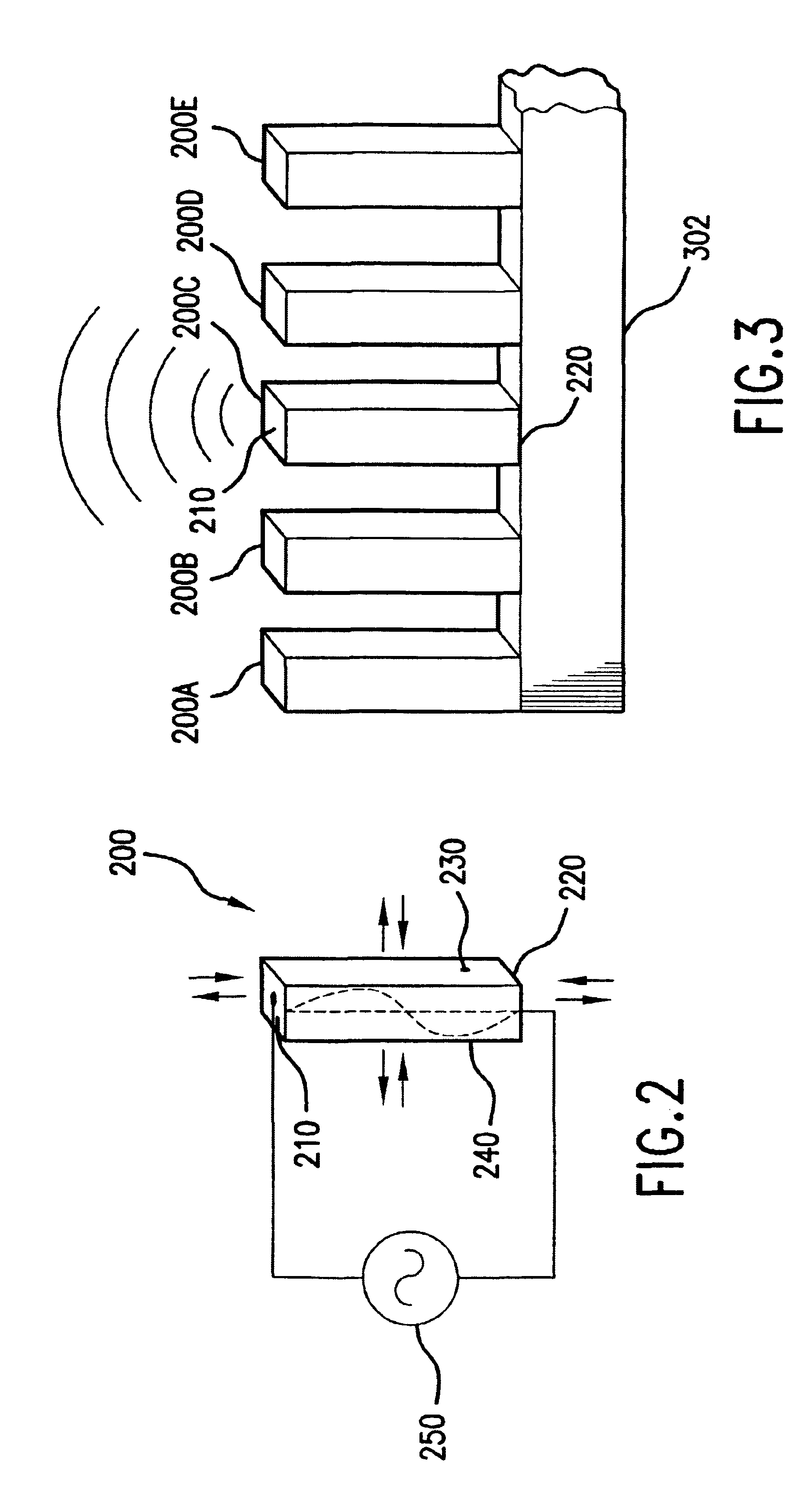

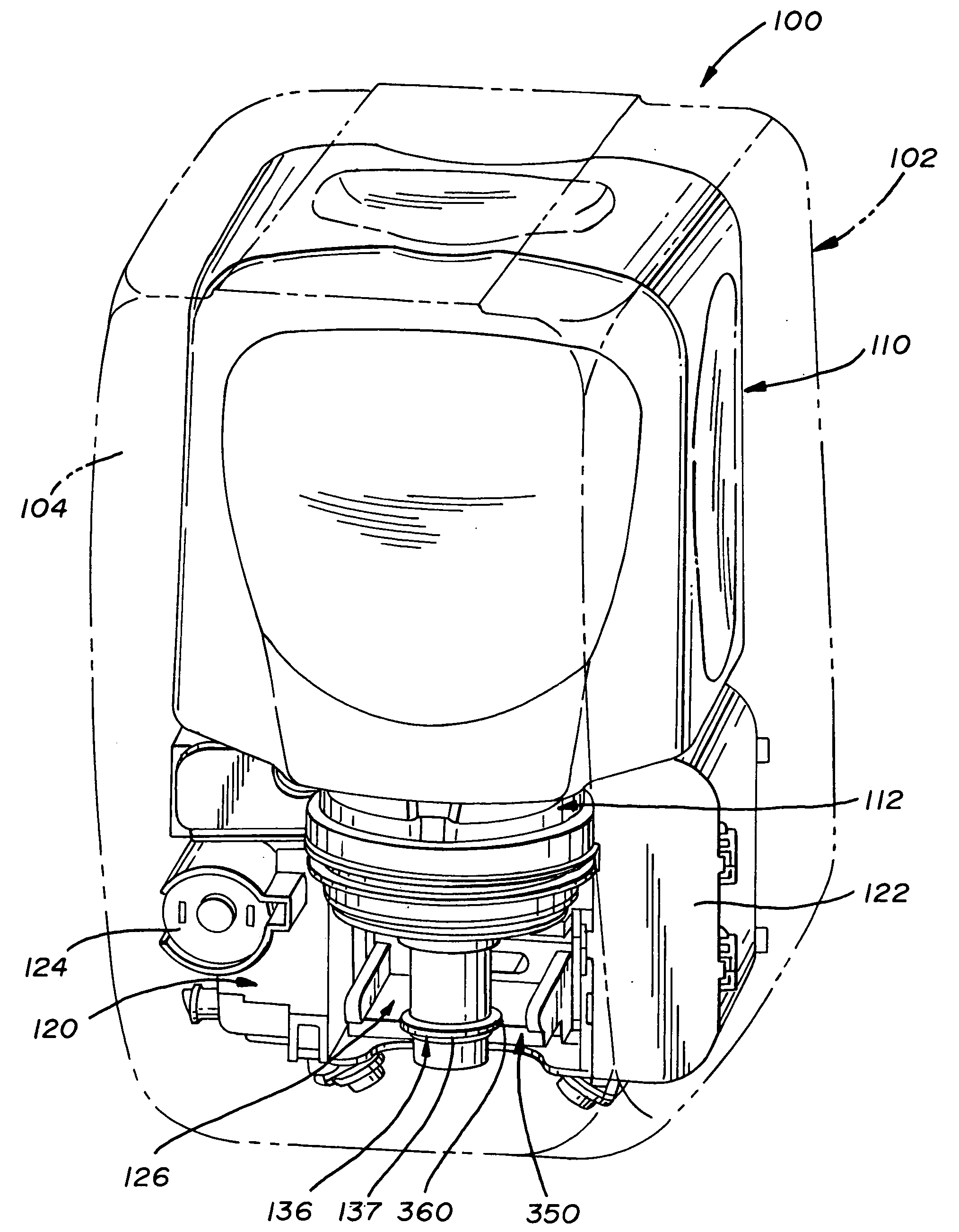

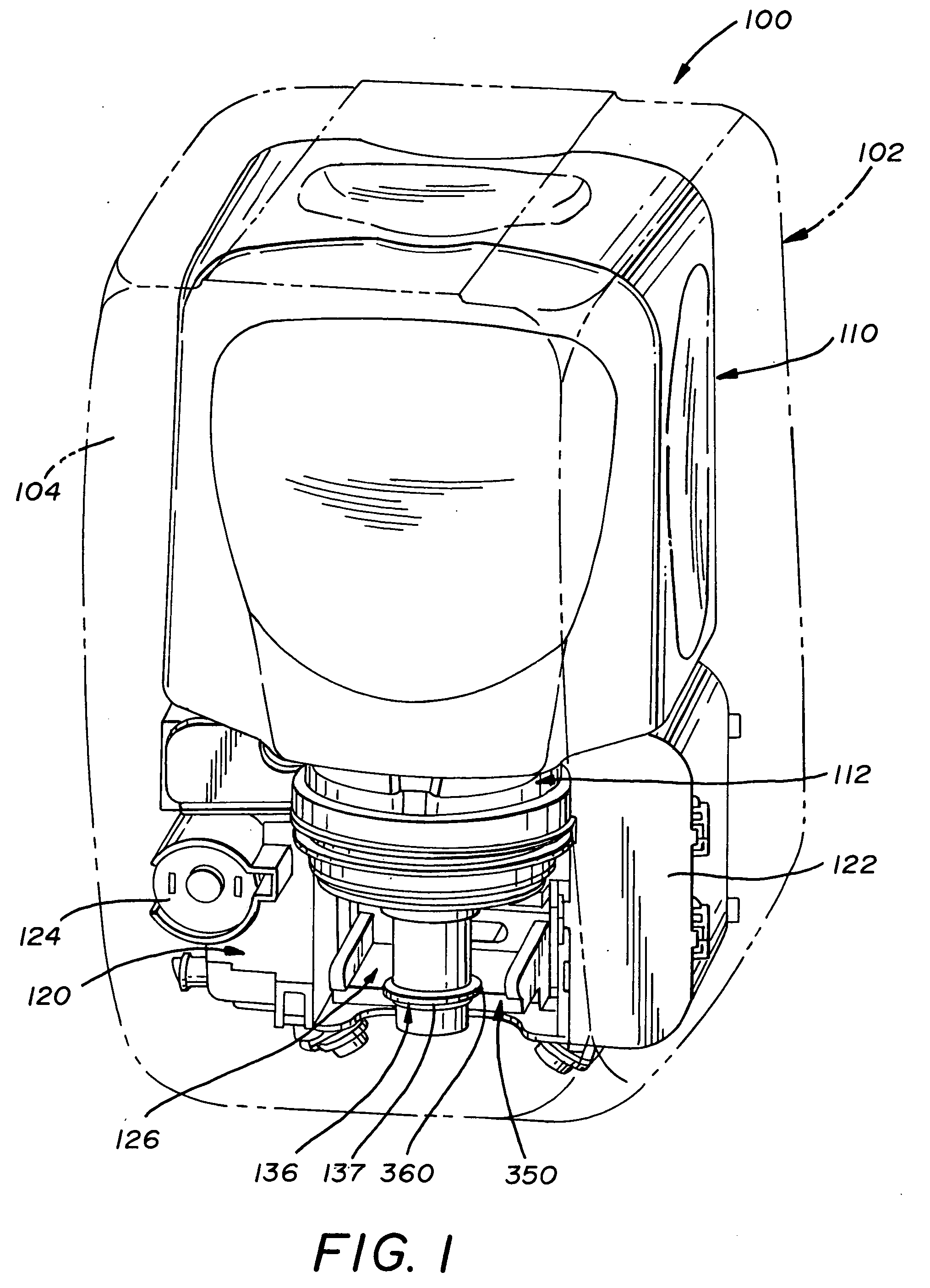

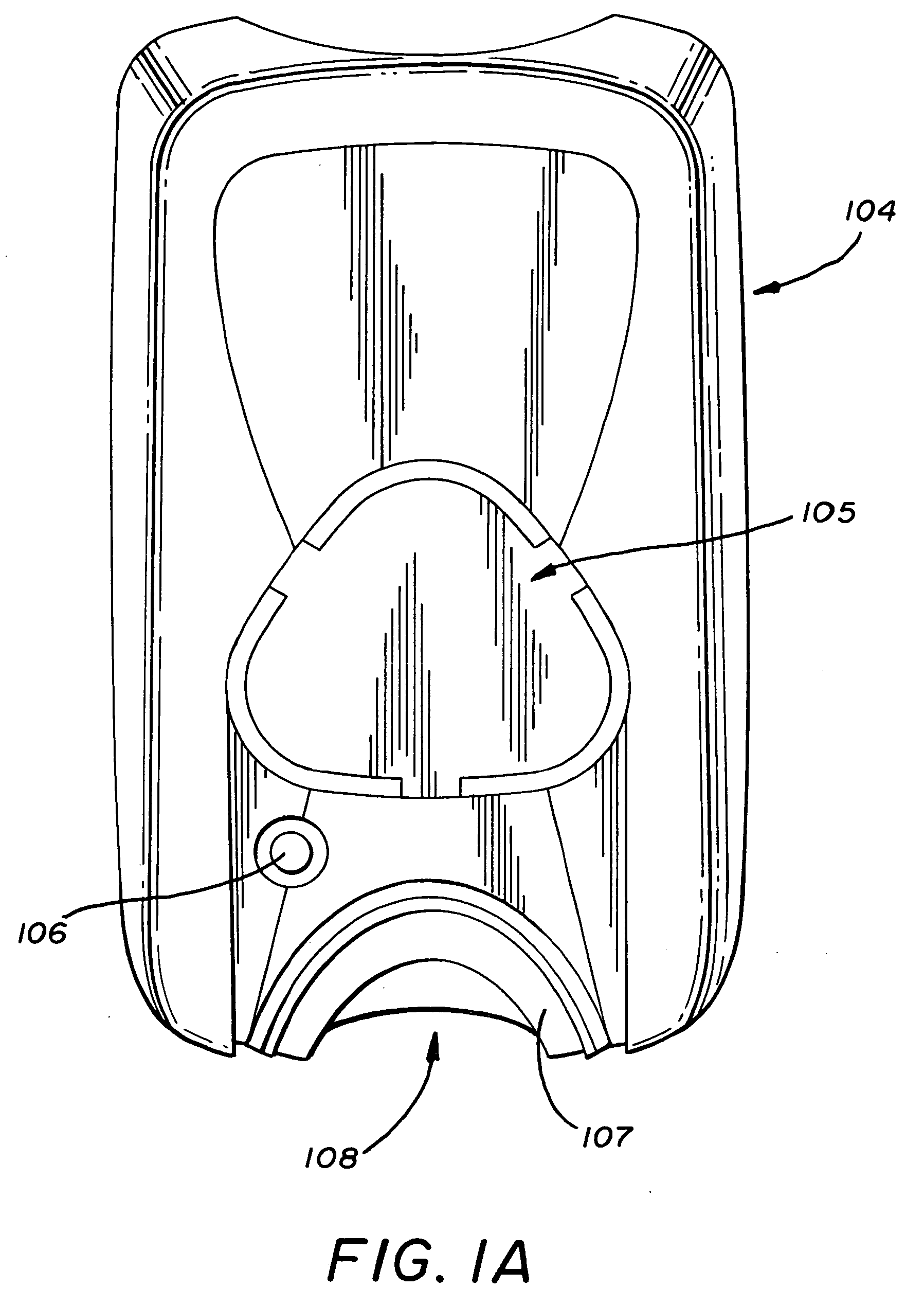

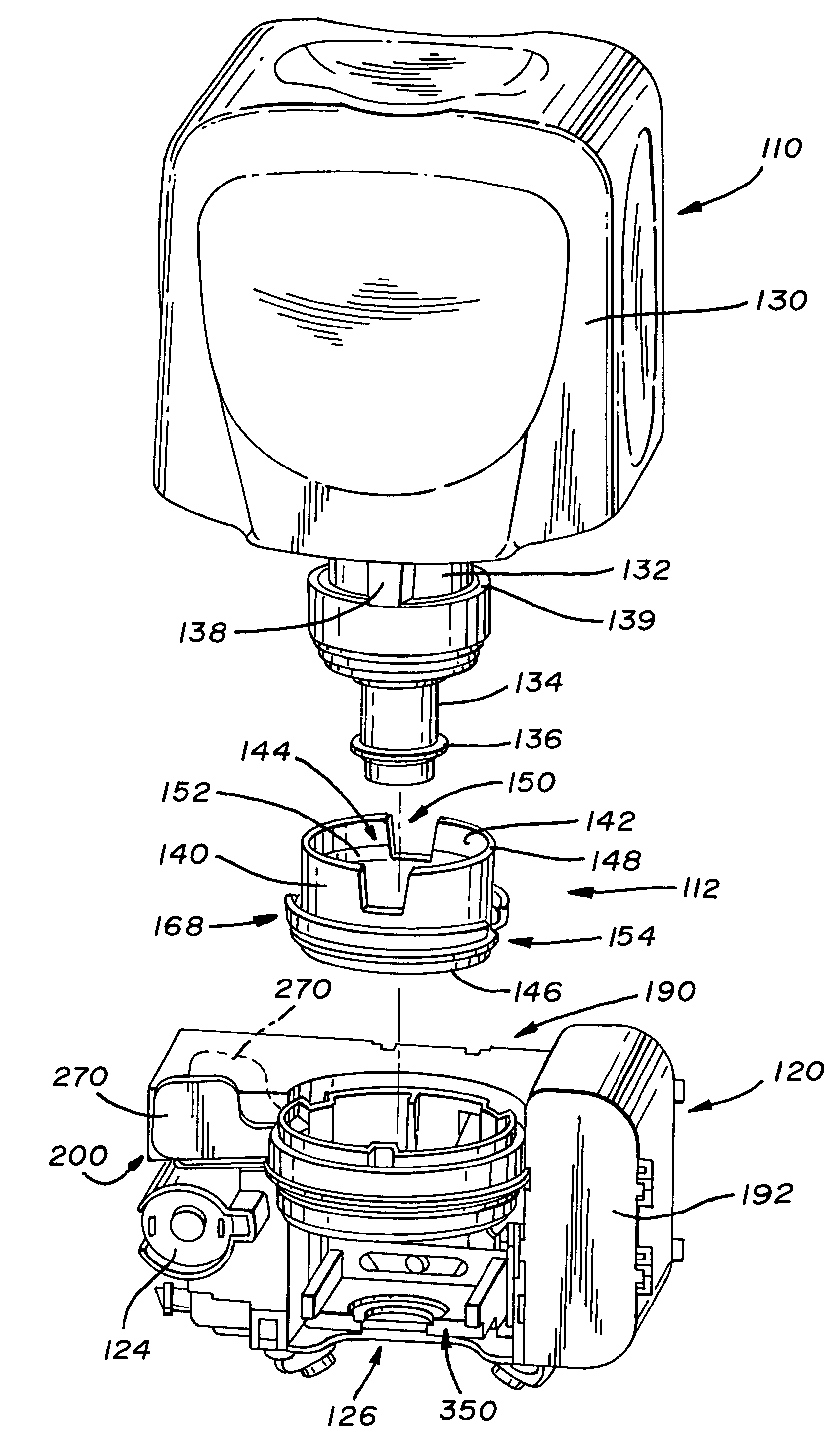

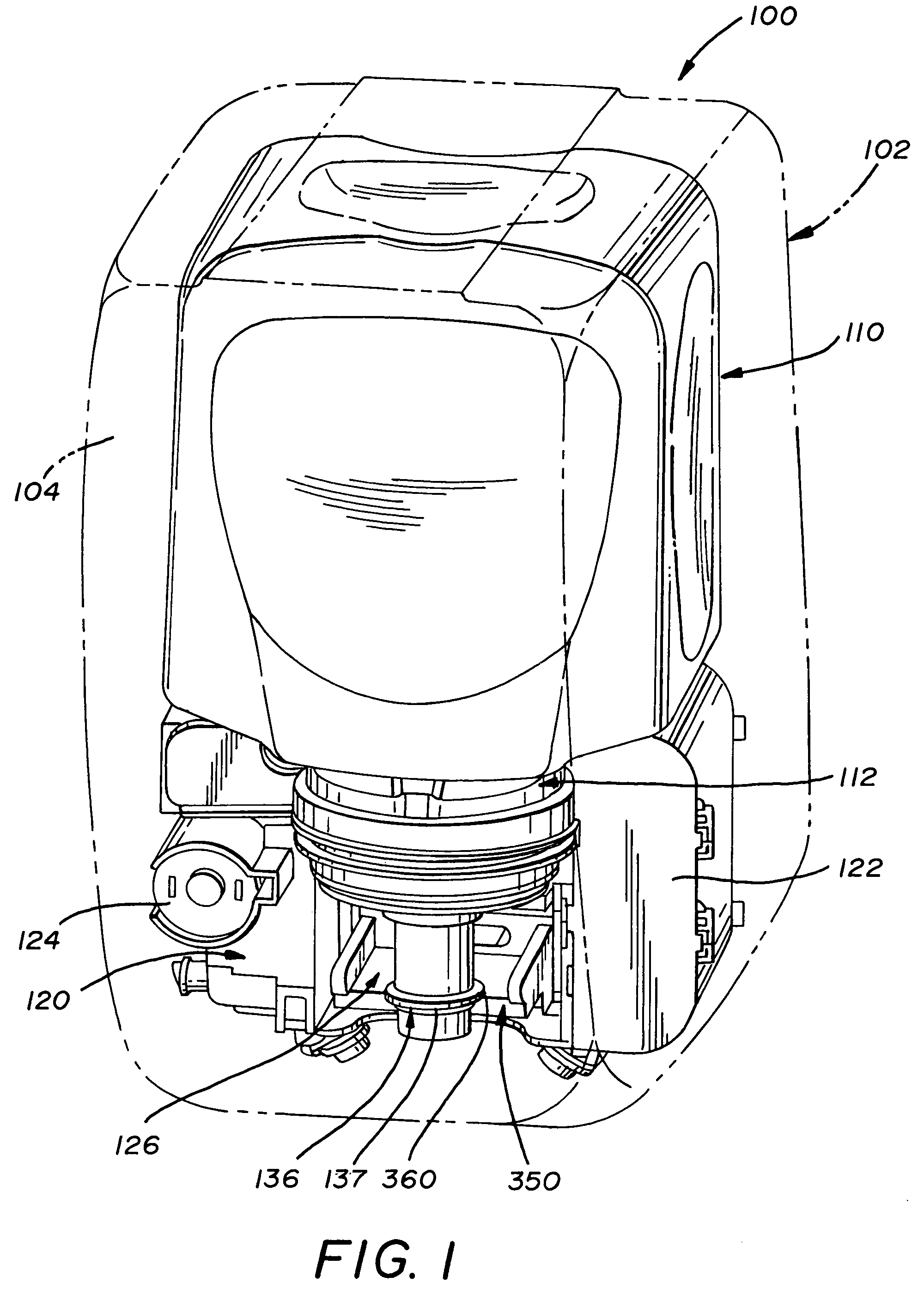

Electronically keyed dispensing systems and related methods utilizing near field frequency response

ActiveUS20060124662A1Optimize quantityAcutation objectsIndication apparatusEngineeringMechanical engineering

A dispensing system is disclosed which utilizes an electronically powered key device and / or identification code associated with a refill container to preclude the need for mechanical keys. The system utilizes a near field frequency response to determine whether a refill container is compatible with a dispensing system. In particular, the refill container is provided with a coil terminated by one of a number of capacitors. The container is received in a housing that provides a pair of coils that are in a spatial relationship with the installed refill container's coil. By energizing one of the housing's coils, the other coil detects a unique electronic signature generated by the container's coil. If the signature is acceptable, the dispensing system is allowed to dispense a quantity of material. The system also provides a unique latching mechanism to retain the container and ensure positioning of all the coils.

Owner:KANFER JOSEPH

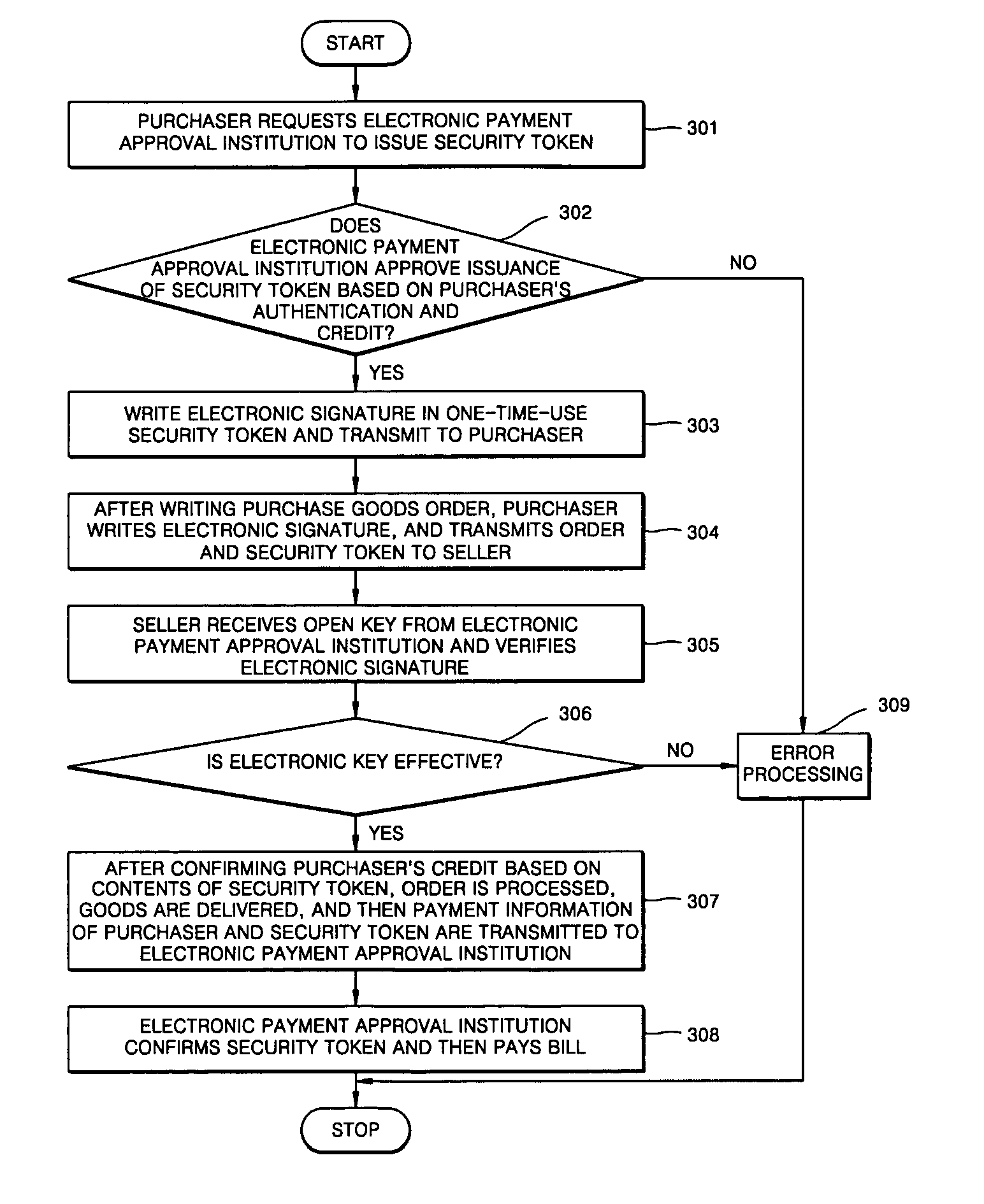

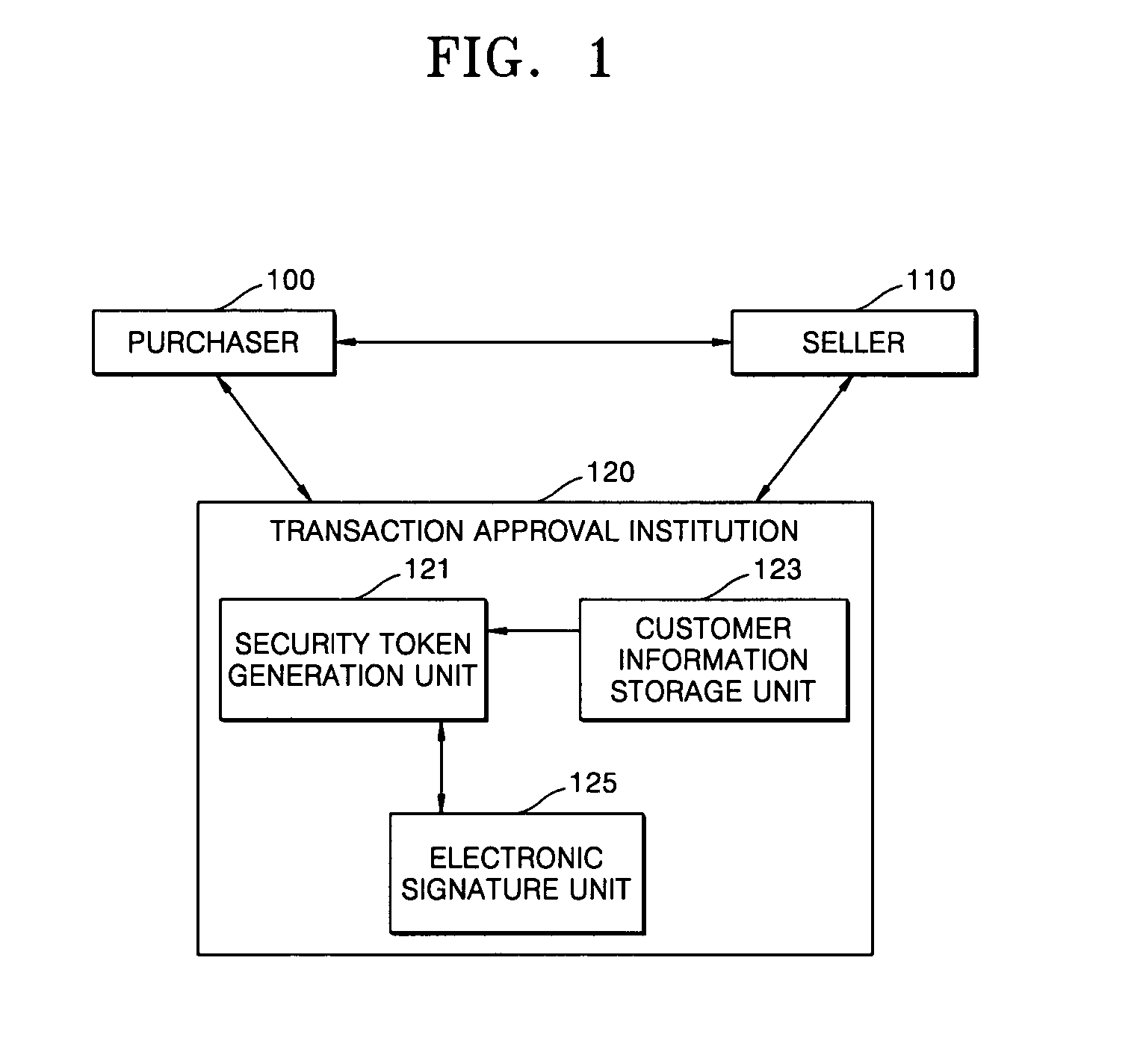

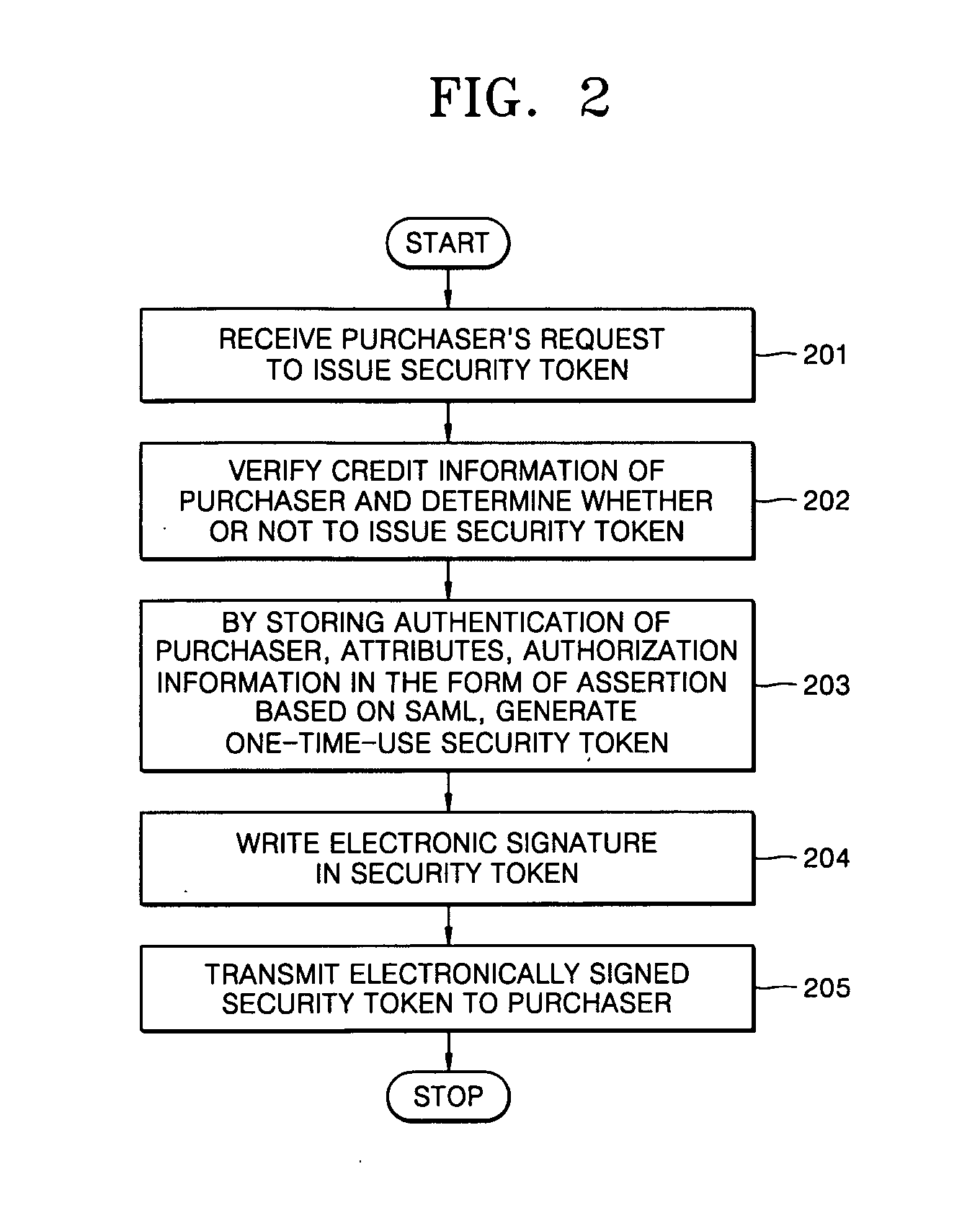

Method for electronic commerce using security token and apparatus thereof

InactiveUS20050097060A1Securing communicationPayments involving neutral partyConfidentialityExtensible markup

A method for electronic commerce using a security token and an apparatus thereof are provided. The electronic commerce method using a security token comprises a transaction approval institution generating a security token based on a security assertion markup language (SAML), using credit information of a purchaser who requests to issue a security token, and transmitting the security token to the purchaser; the purchaser writing an electronic signature on an order and transmitting the order together with the security token to a seller; the seller verifying the received order and security token, and then delivering goods according to the order to the purchaser; and the transaction approval institution performing payment for the seller and the purchaser. The method can solve the problems of personal information leakage and privacy infringement that may happen when a purchaser sends his personal information to a seller for electronic commerce. Since the token is one-time-use data, even if a security token sent is counterfeited or stolen, the loss can be minimized. In addition, by writing an extensible markup language (XML) electronic signature in the security token, authentication, integrity, and non-repudiation for a transmitted message can be guaranteed and through simple object access protocol (SOAP) security technology, confidentiality is maintained.

Owner:ELECTRONICS & TELECOMM RES INST

Electronically keyed dispensing systems and related methods utilizing near field frequency response

A dispensing system is disclosed which utilizes an electronically powered key device and / or identification code associated with a refill container to preclude the need for mechanical keys. The system utilizes a near field frequency response to determine whether a refill container is compatible with a dispensing system. In particular, the refill container is provided with a coil terminated by one of a number of capacitors. The container is received in a housing that provides a pair of coils that are in a spatial relationship with the installed refill container's coil. By energizing one of the housing's coils, the other coil detects a unique electronic signature generated by the container's coil. If the signature is acceptable, the dispensing system is allowed to dispense a quantity of material. The system also provides a unique latching mechanism to retain the container and ensure positioning of all the coils.

Owner:KANFER JOSEPH

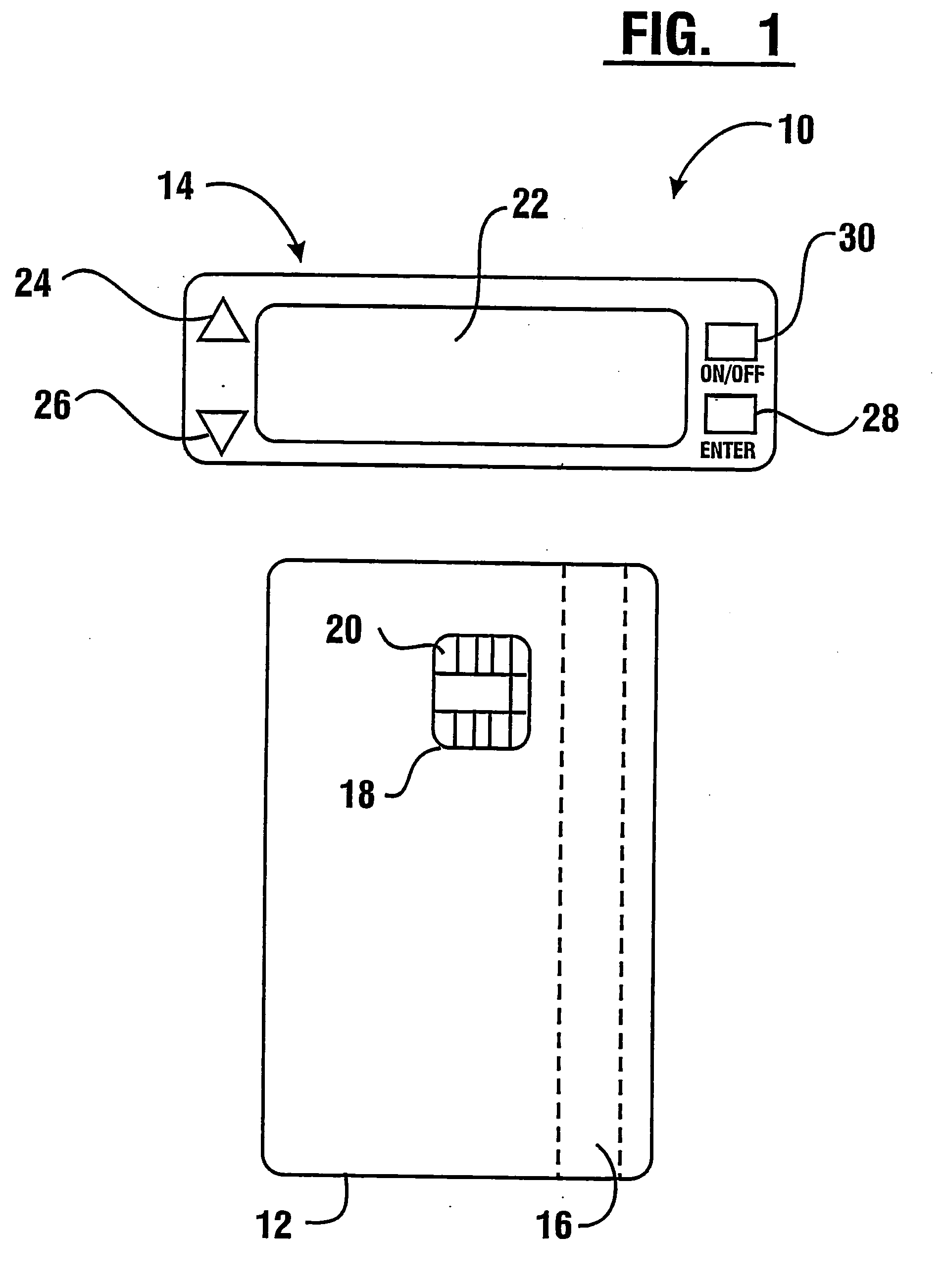

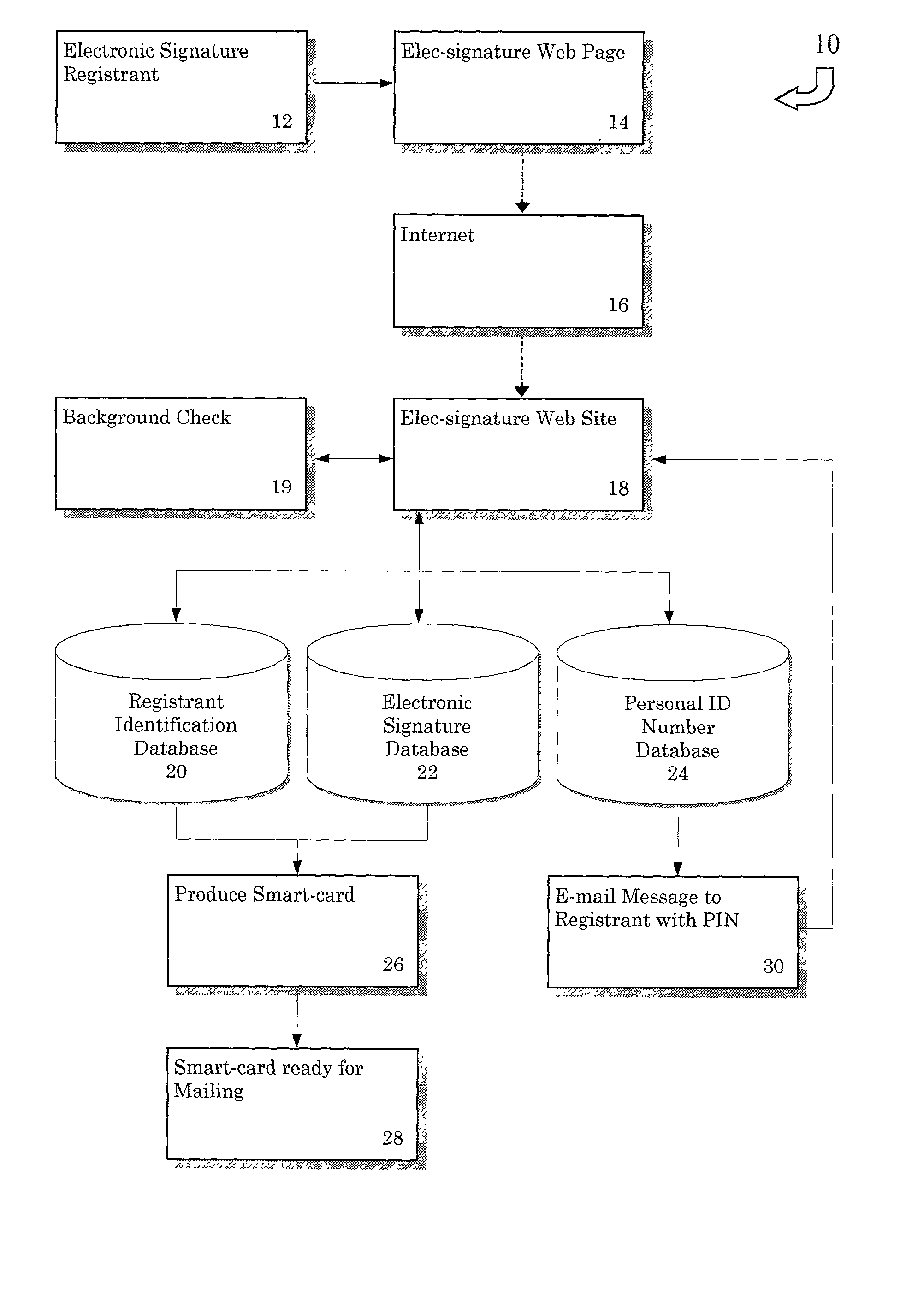

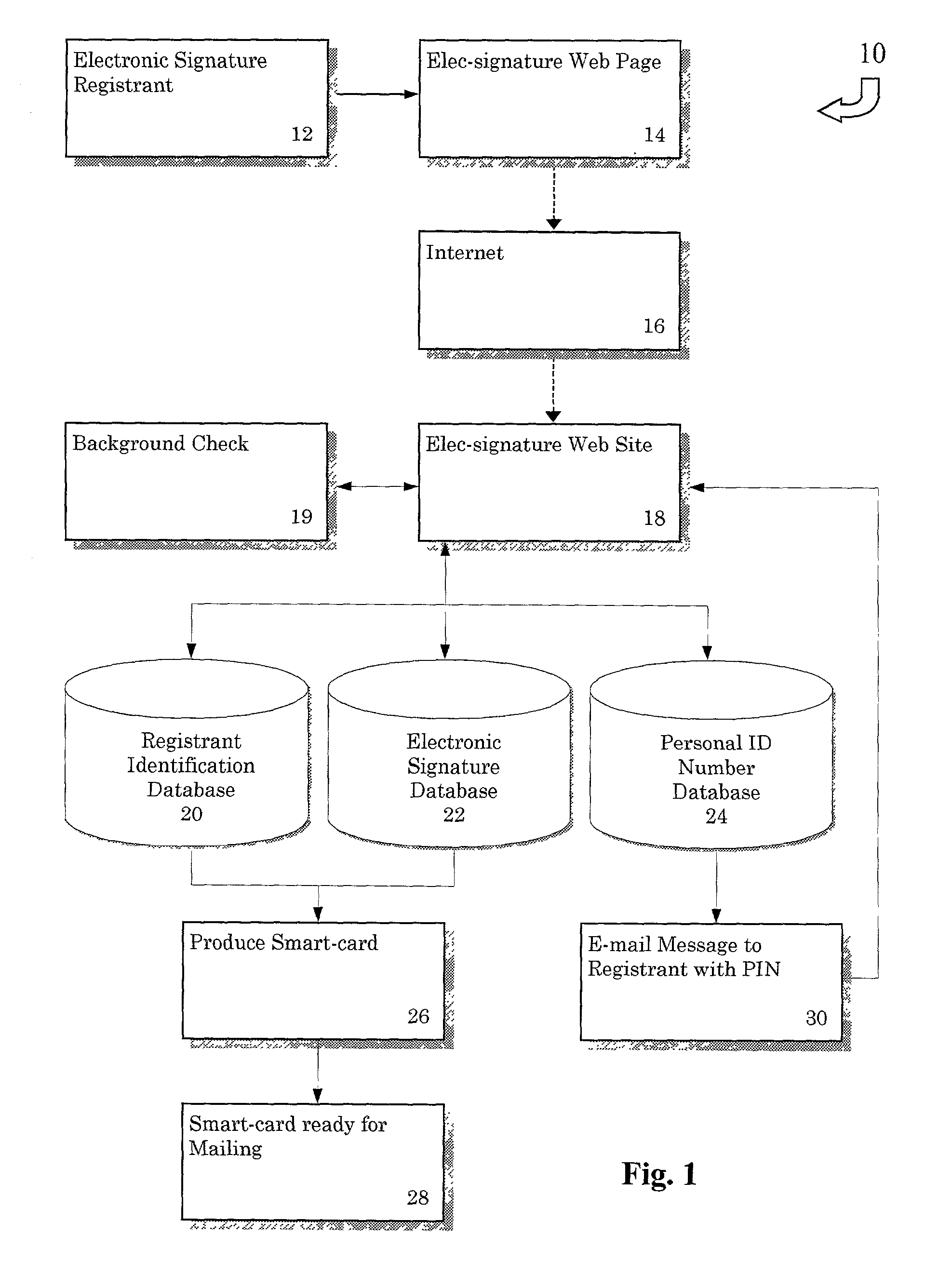

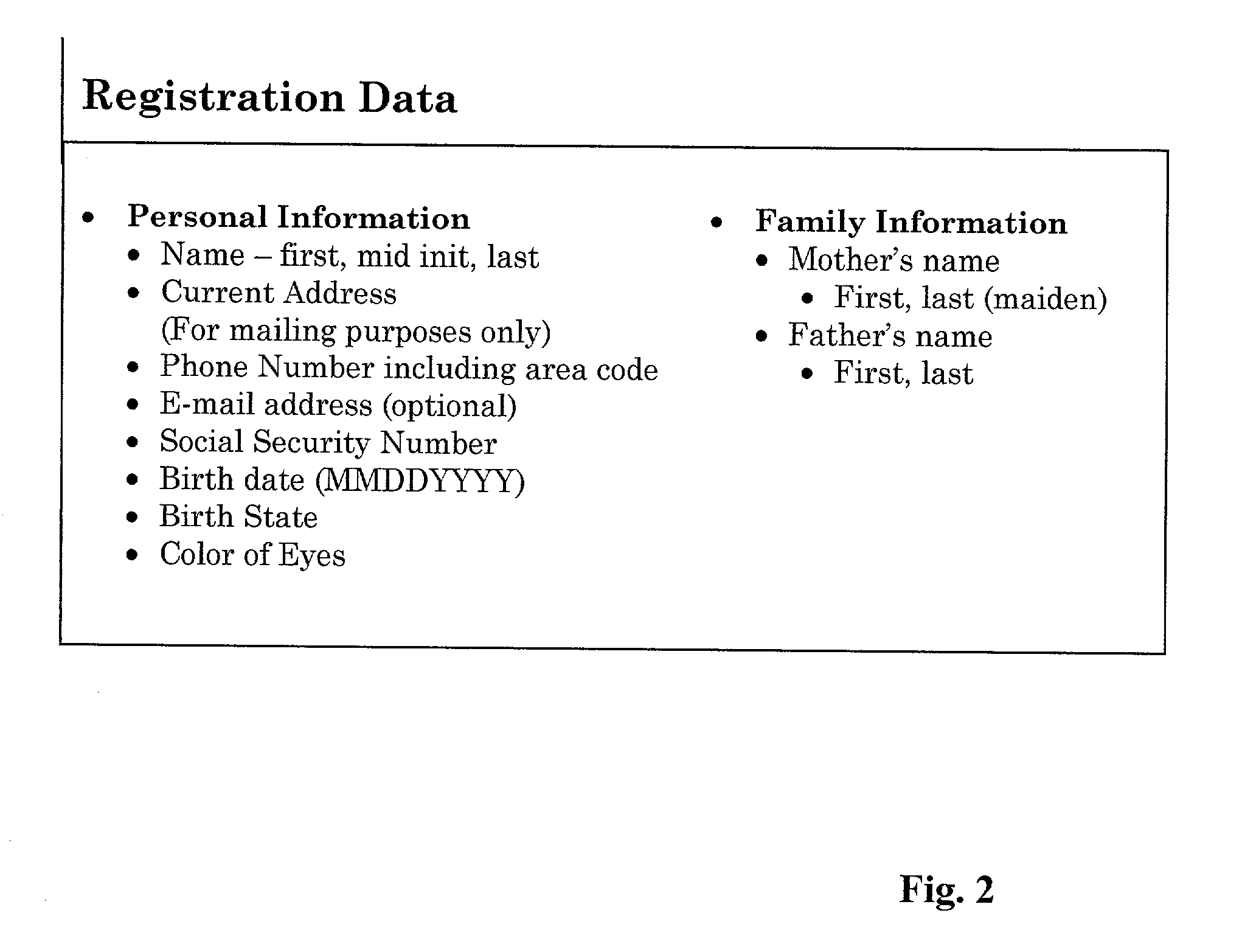

Electronic signature system

InactiveUS20020042879A1User identity/authority verificationPayment architectureIdentity theftCard reader

A method of producing an electronic signature and a system for verifying that signature by a licensed vendor. Personal information is received by an individual wishing to utilize this system. This personal information would be used to produce an electronic signature, including an authentication number. The electronic signature, as well as the means for producing the authentication number, can be created through the use of a electronic signature card. This card can be inserted into a reader and the licensed vendor can compare the generated authentication number with an authentication number associated with the individual. Once the electronic signature is verified, a particular commercial transaction can be completed. Additionally, the present invention can be used to ensure the integrity of the document after the electronic signature has been attached thereto. This invention prevents identity theft, as well as minimizing the risk of unauthorized use of the signature card to sign a document in another person's name.

Owner:LEGACY SYST DEV

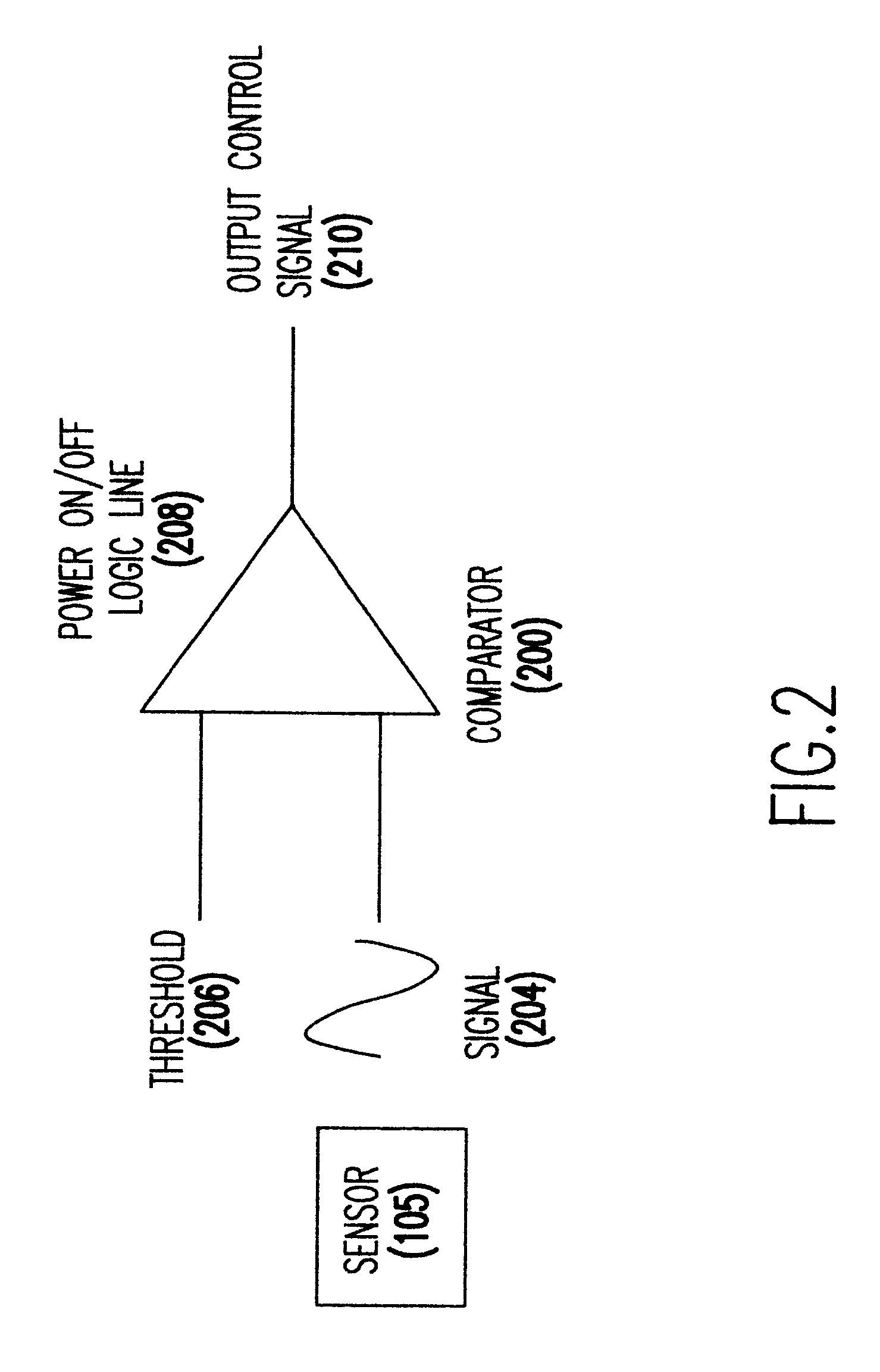

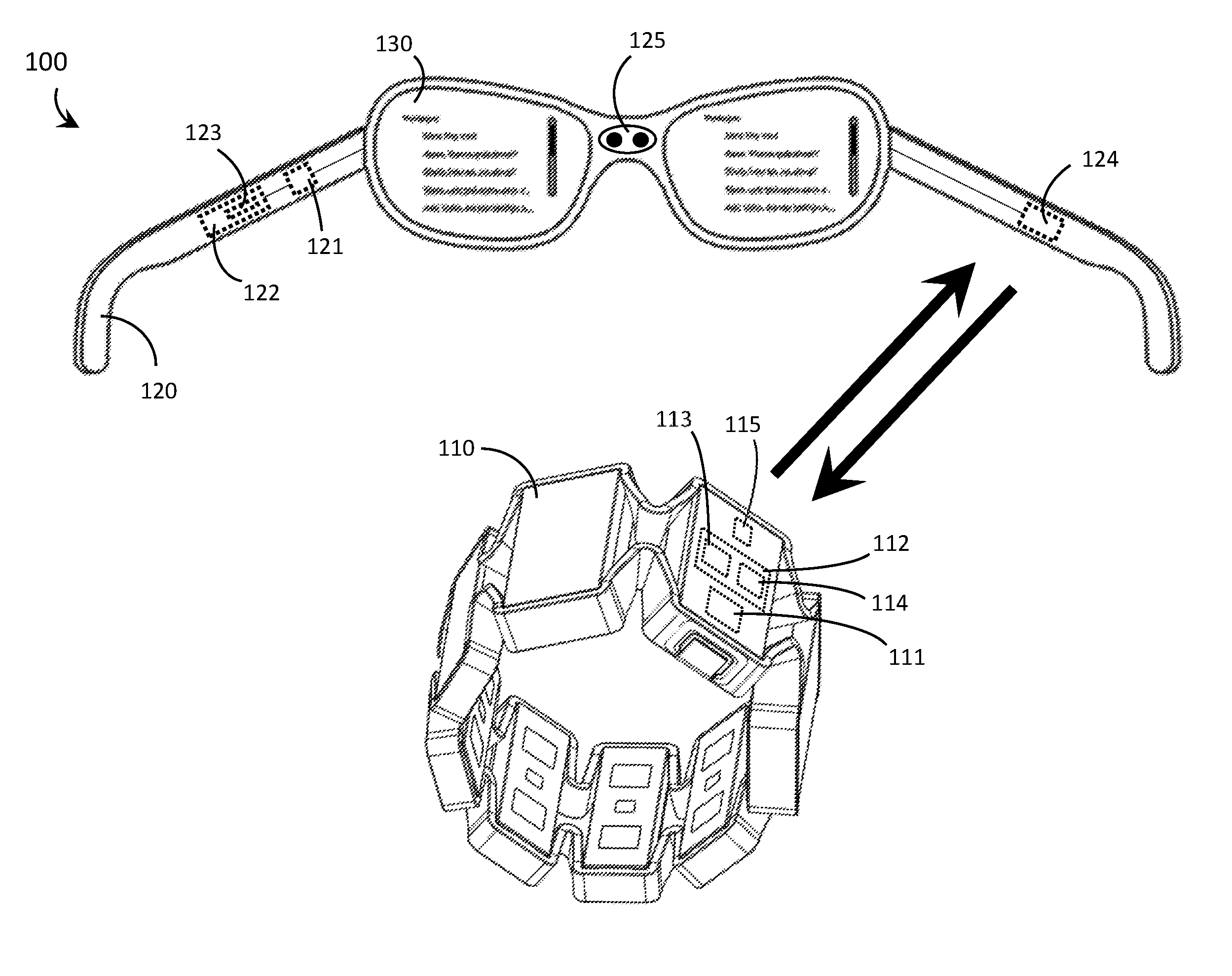

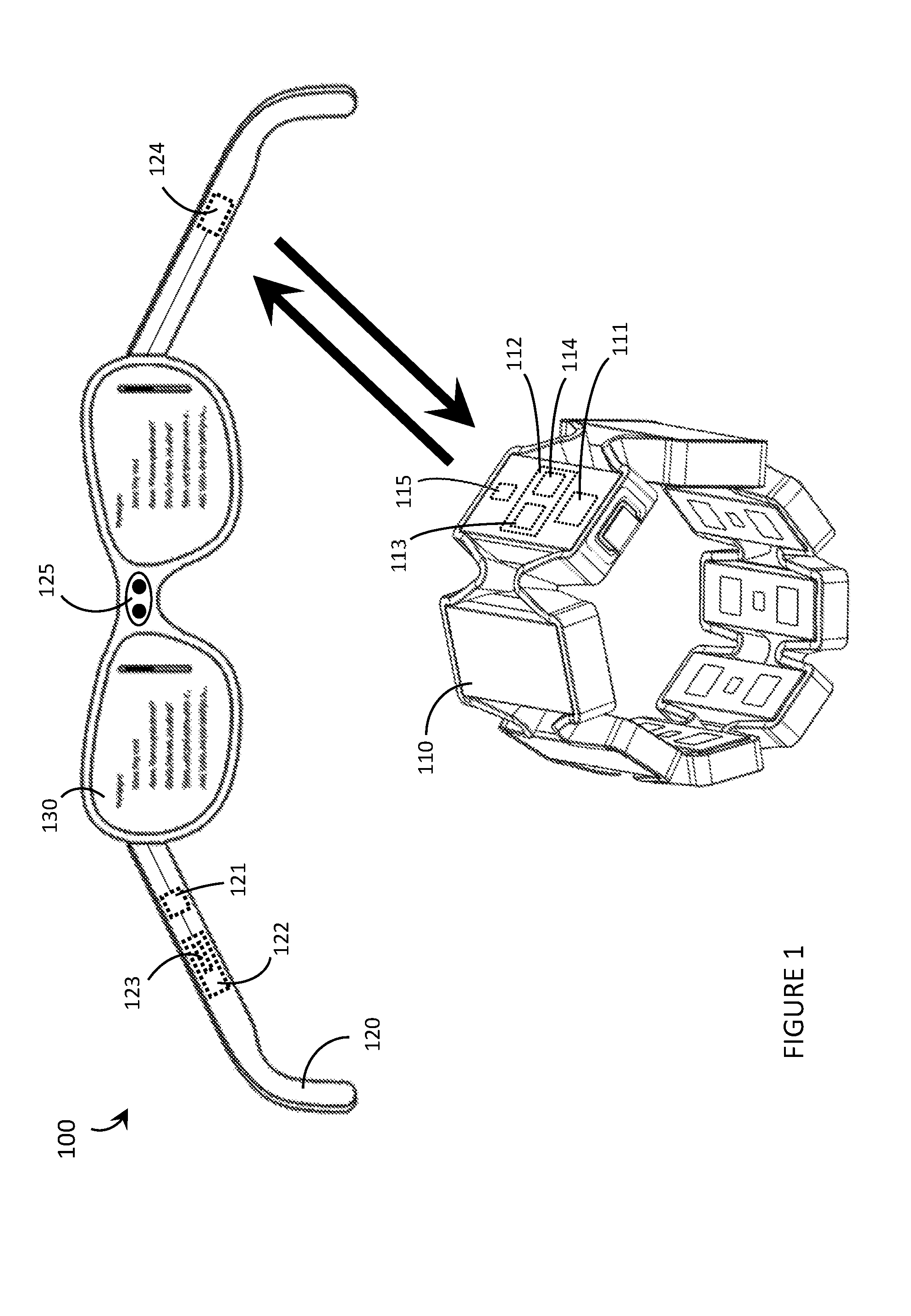

Systems, devices, and methods for mitigating false positives in human-electronics interfaces

InactiveUS20160274758A1Input/output for user-computer interactionDetails for portable computersHuman–computer interactionEquipment use

Systems, devices, and methods for mitigating false-positives in human-electronics interfaces are described. A human-electronics interface includes a first interface device that is responsive to inputs of a first form from a user and a second interface device that is responsive to inputs of a second form from the user. The first interface device enables the user to control the interface through inputs of the first form while the second interface device enables the user to control, through inputs of the second form, at least a locked / unlocked state of the interface with respect to the first interface device. In the locked state, the interface is unresponsive to inputs (in particular, accidental inputs or “false-positives”) of the first form whereas in the unlocked state the interface is responsive to inputs of the first form.

Owner:GOOGLE LLC

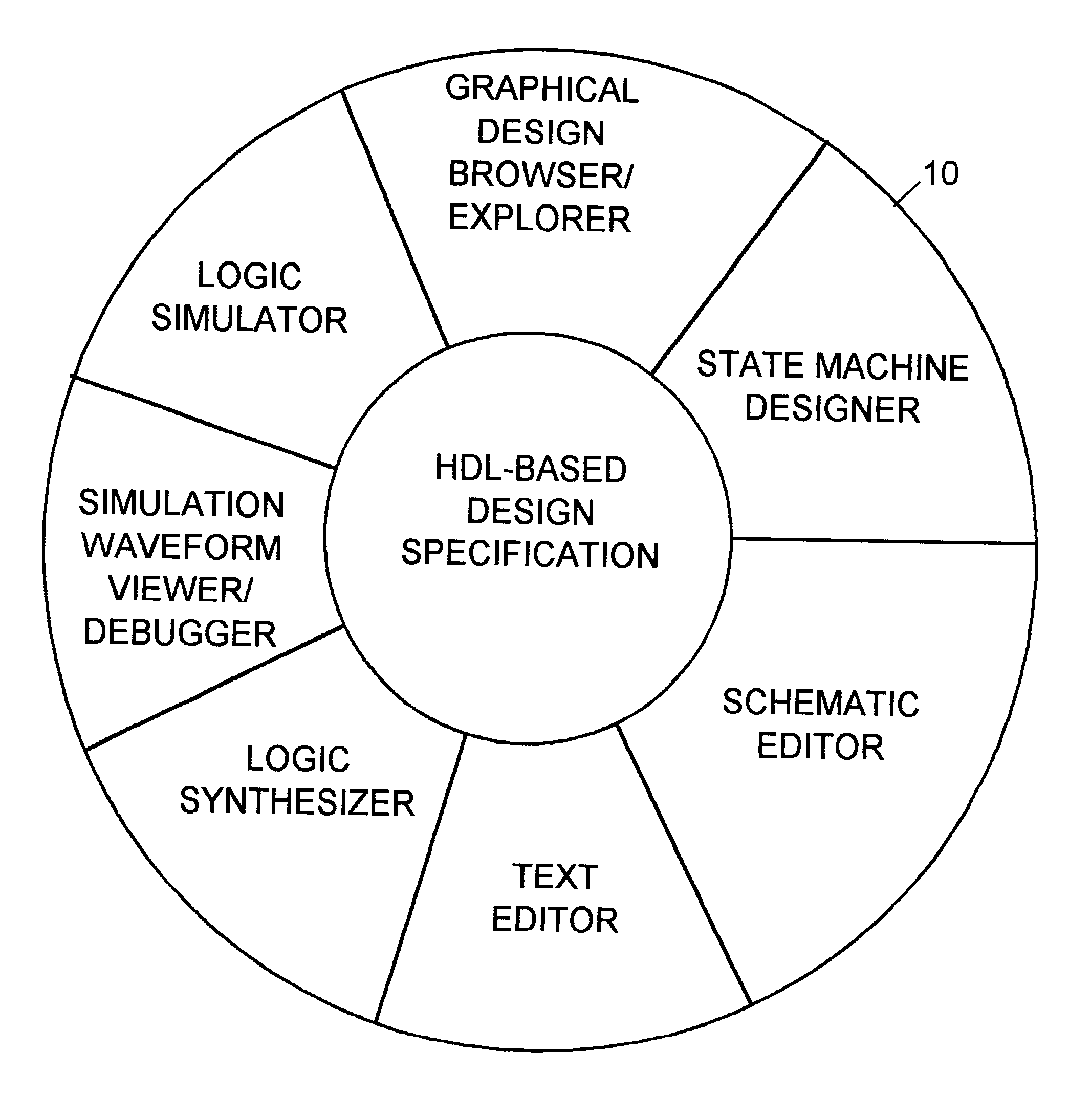

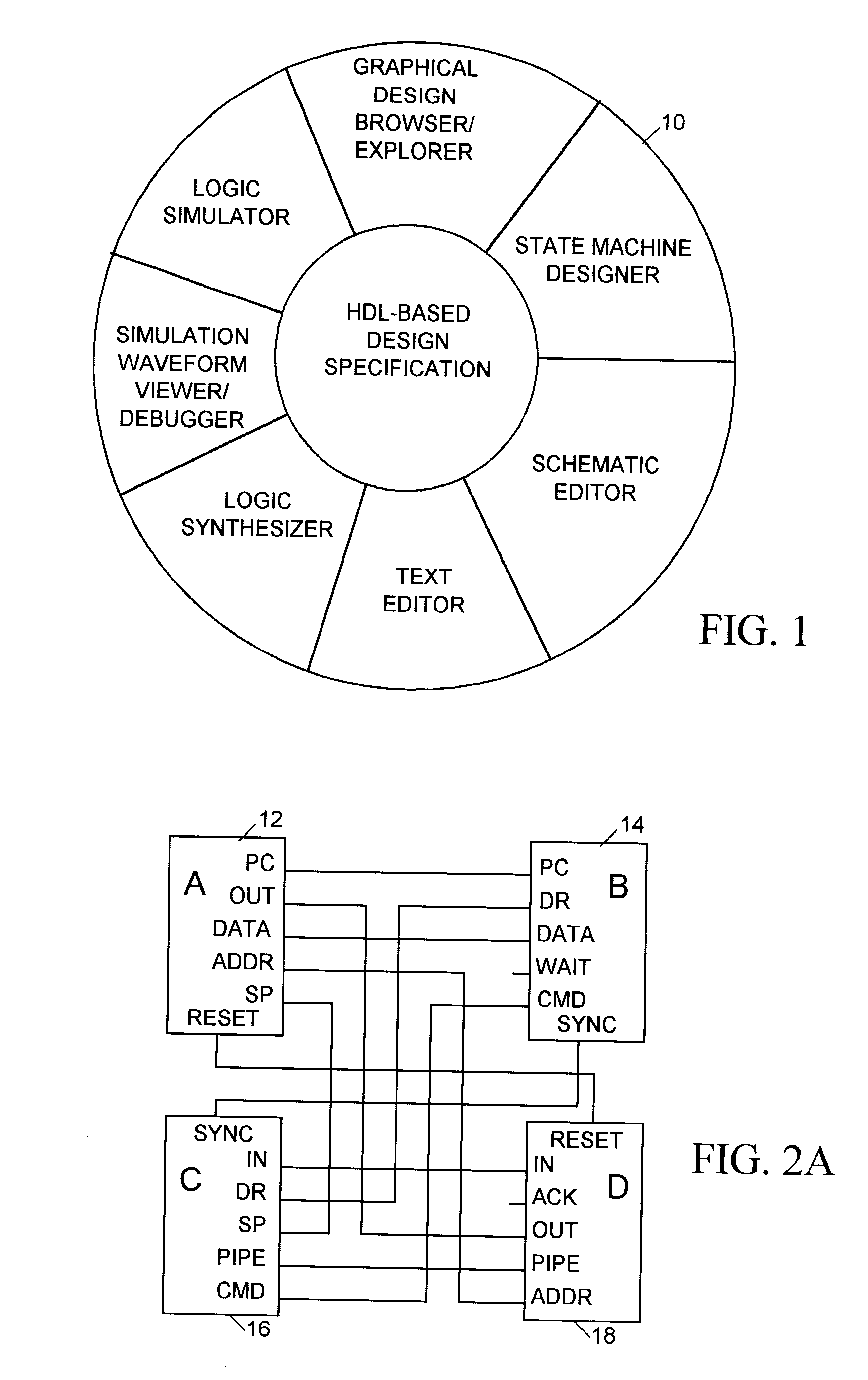

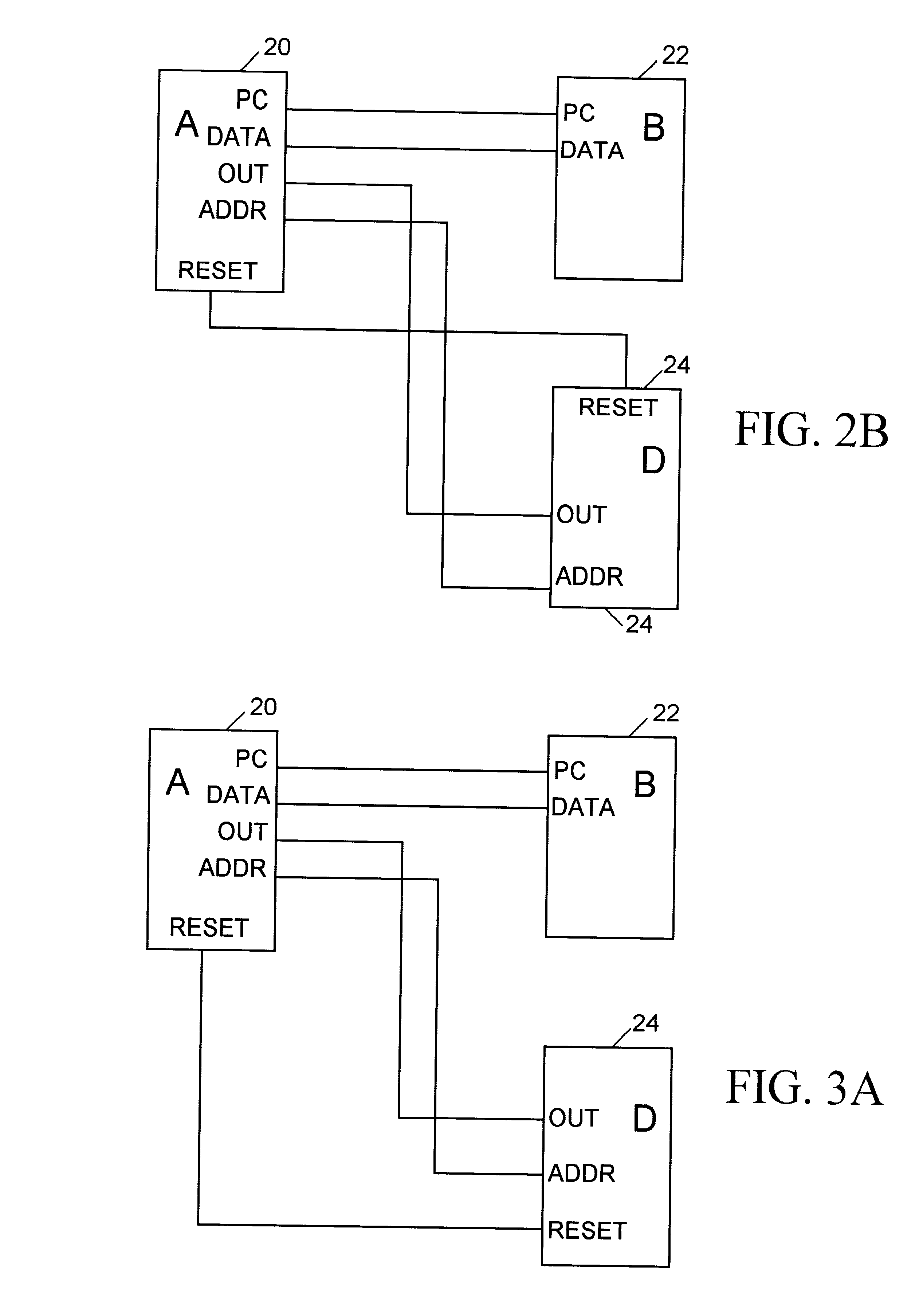

System and method for browsing graphically an electronic design based on a hardware description language specification

InactiveUS6366874B1CAD circuit designSoftware simulation/interpretation/emulationGraphicsProgramming language

Hardware description language (HDL)-centered design system and methodology uses HDL specification effectively as master depository for design intent or knowledge. Through network browser, designers conveniently navigate or explore design graphically. Designers selectively review or save design in entirety or portions. Design capture, analysis, and manipulation are based on HDL specification, either directly through text file editing, or indirectly through use of graphical tools.

Owner:SYNOPSYS INC

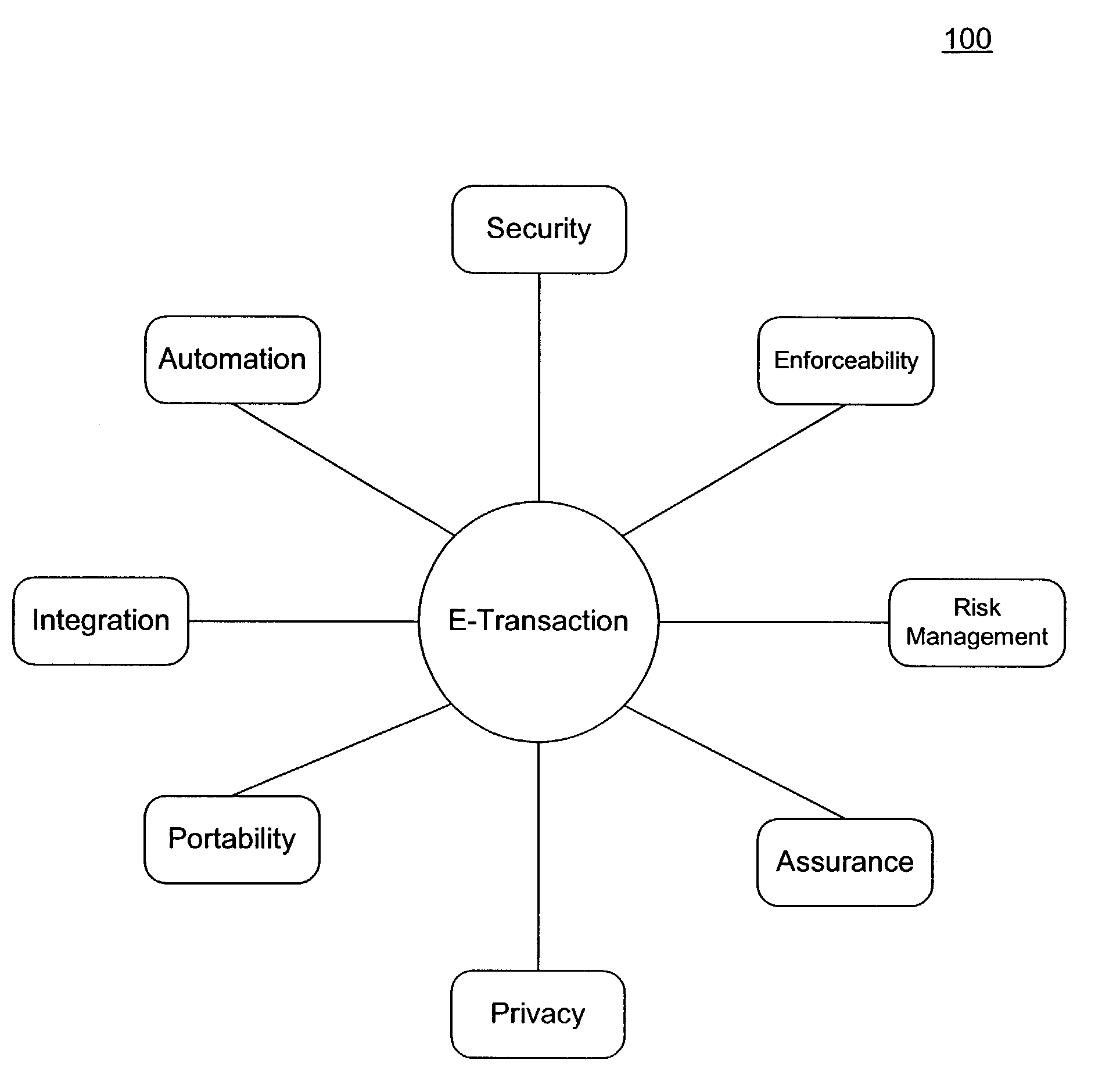

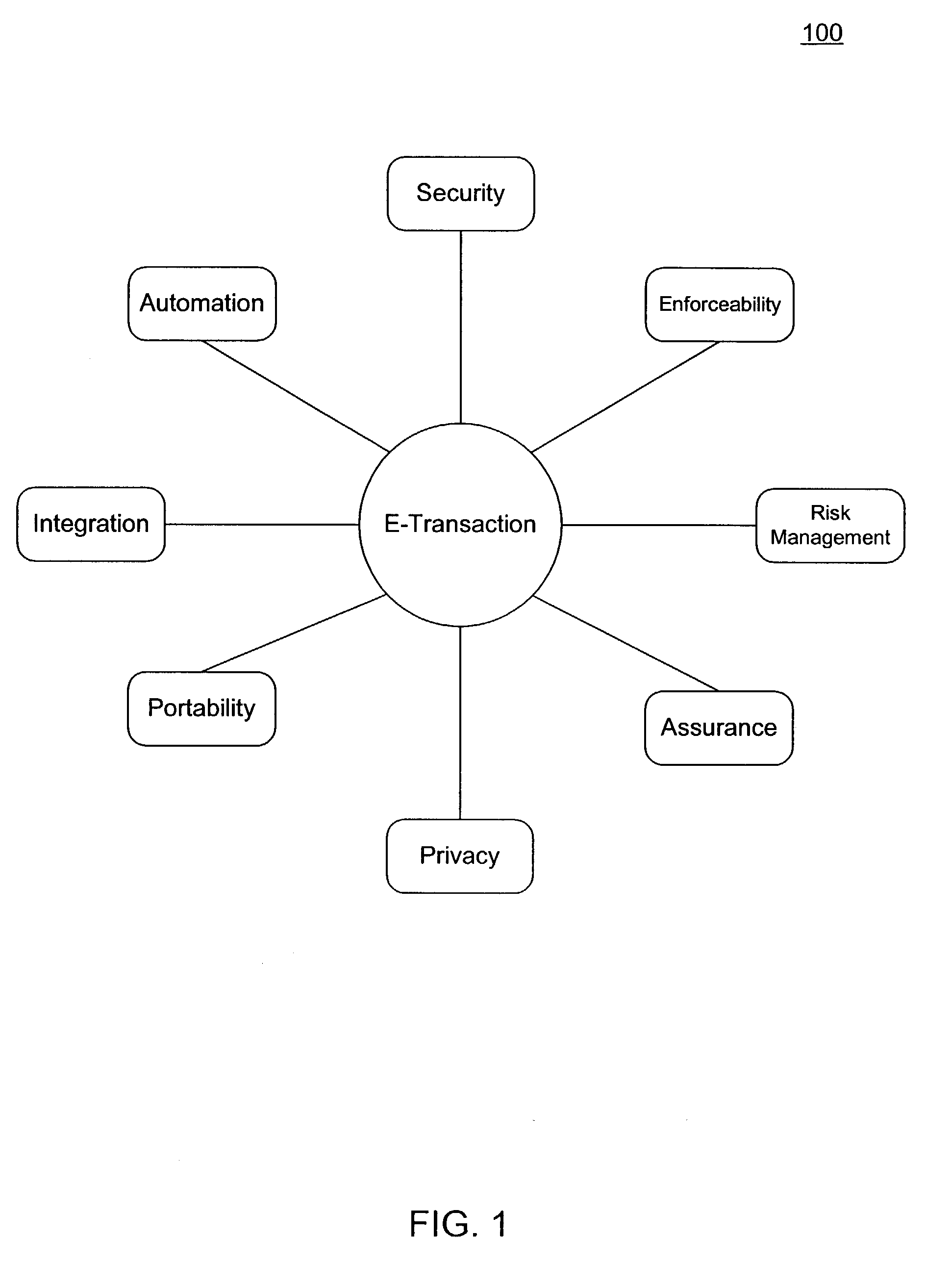

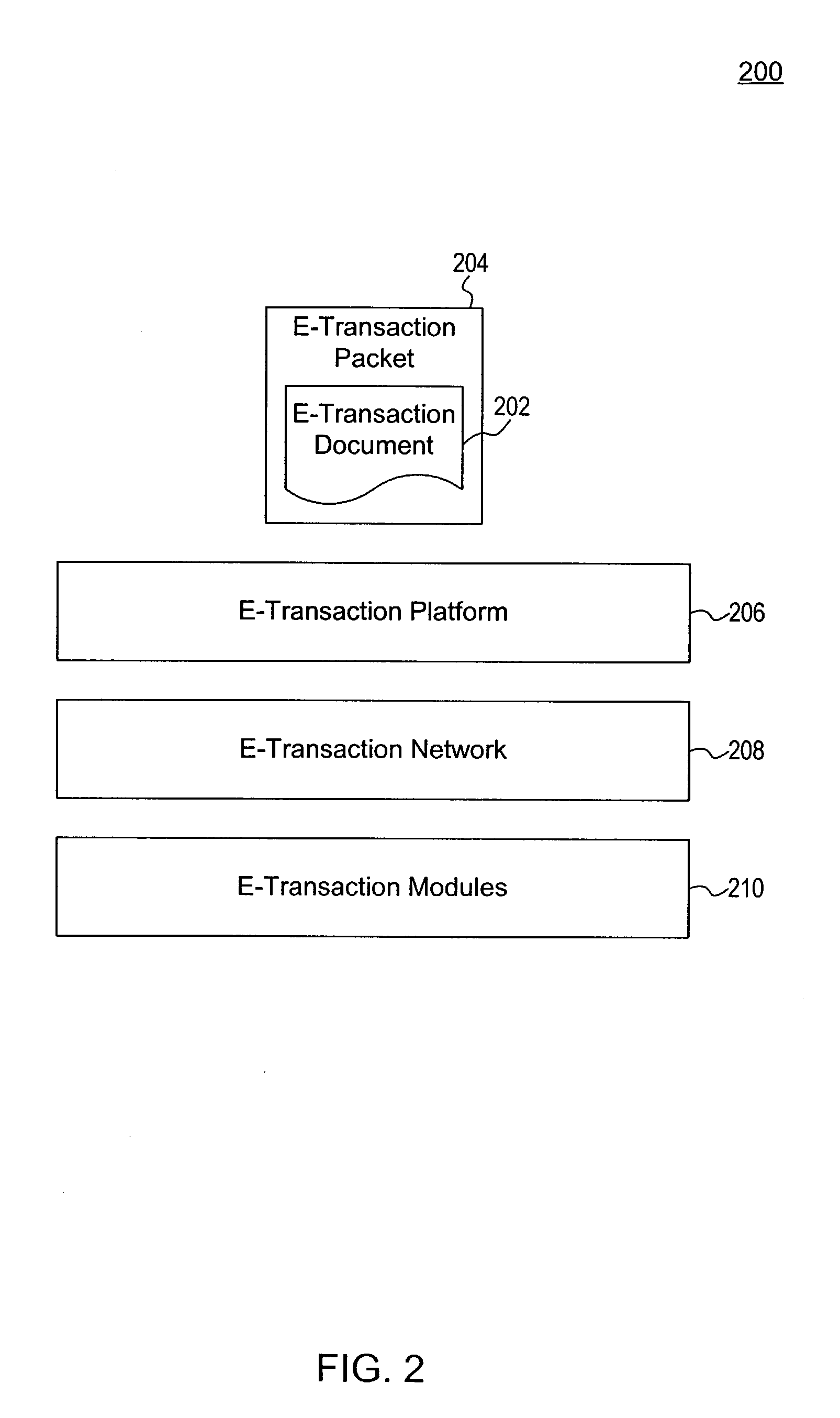

Transaction architecture utilizing transaction policy statements

ActiveUS7698230B1Quicker closure timeIncrease incomePublic key for secure communicationDigital data protectionSchema for Object-Oriented XMLDocumentation

A transaction receiver obtains a transaction packet comprising at least one document and instructions for processing the at least one document to complete a transaction. Thereafter, a rule parser accesses a transaction policy statement associated with the transaction packet including one or more rules for allowing the at least one document to be electronically signed. A verification agent then determines whether the rules of the transaction policy statement are met, after which a signature inhibitor prevents the at least one document from being electronically signed unless each rule of the transaction policy statement is met.

Owner:CONTRACTPAL

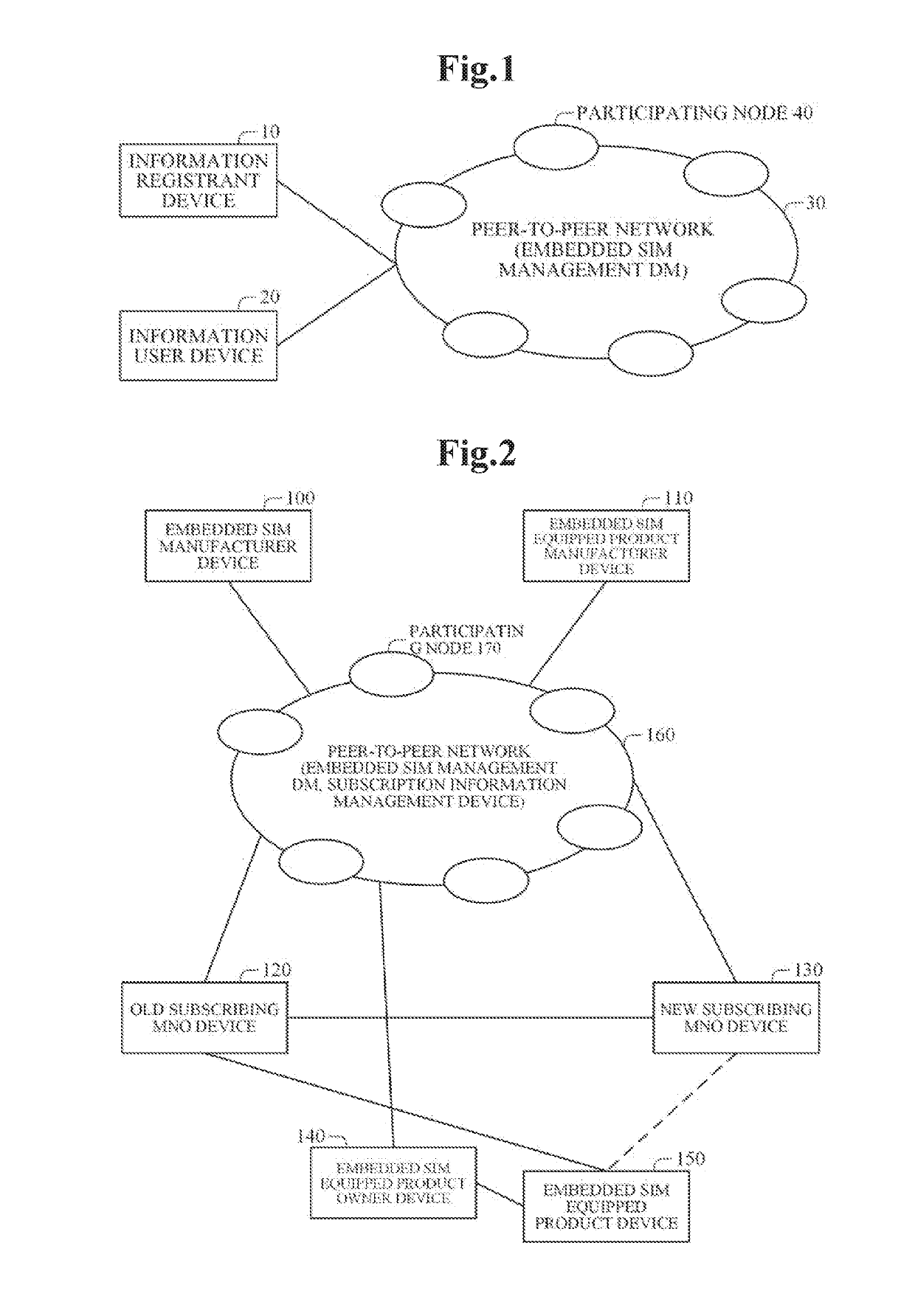

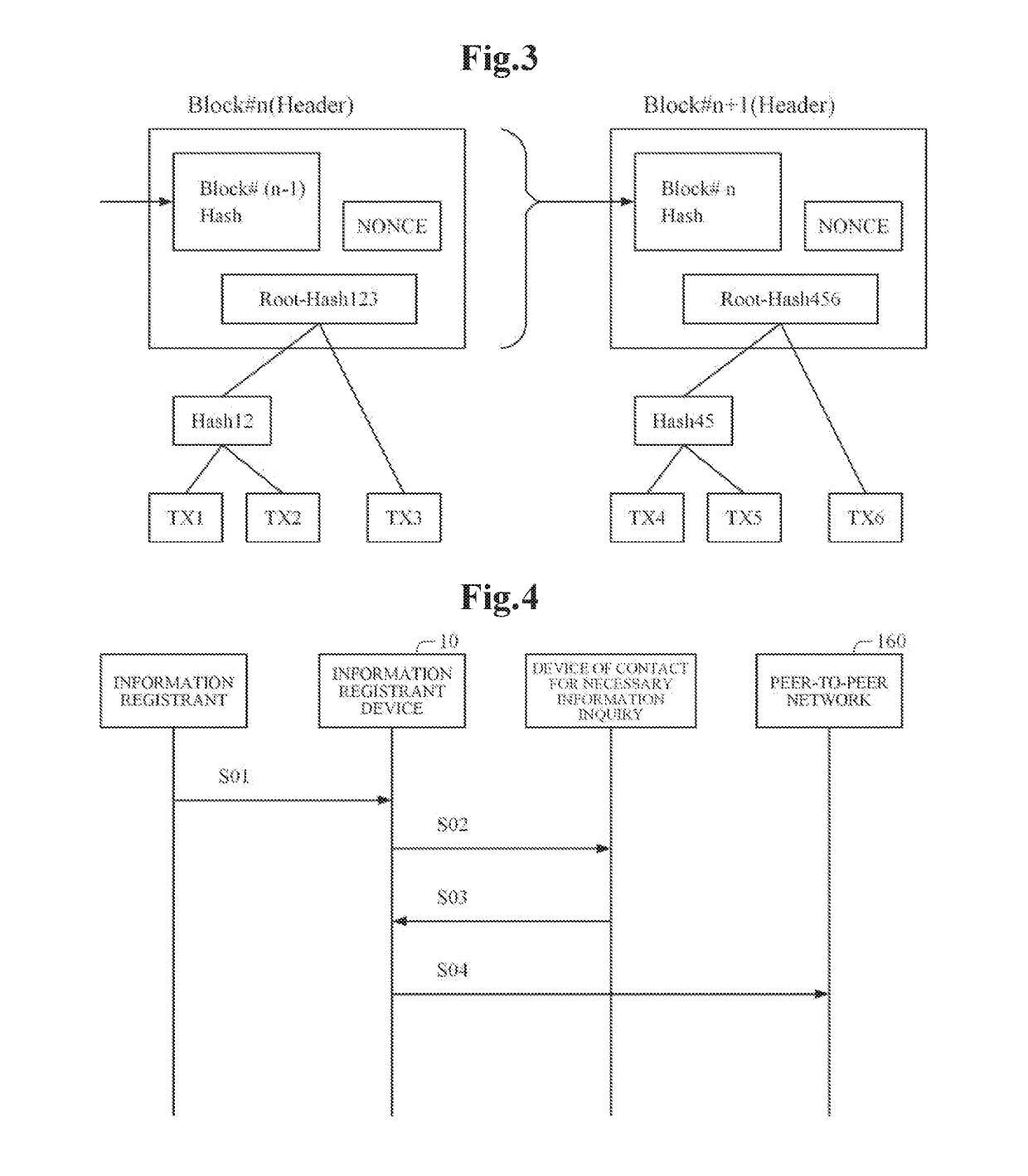

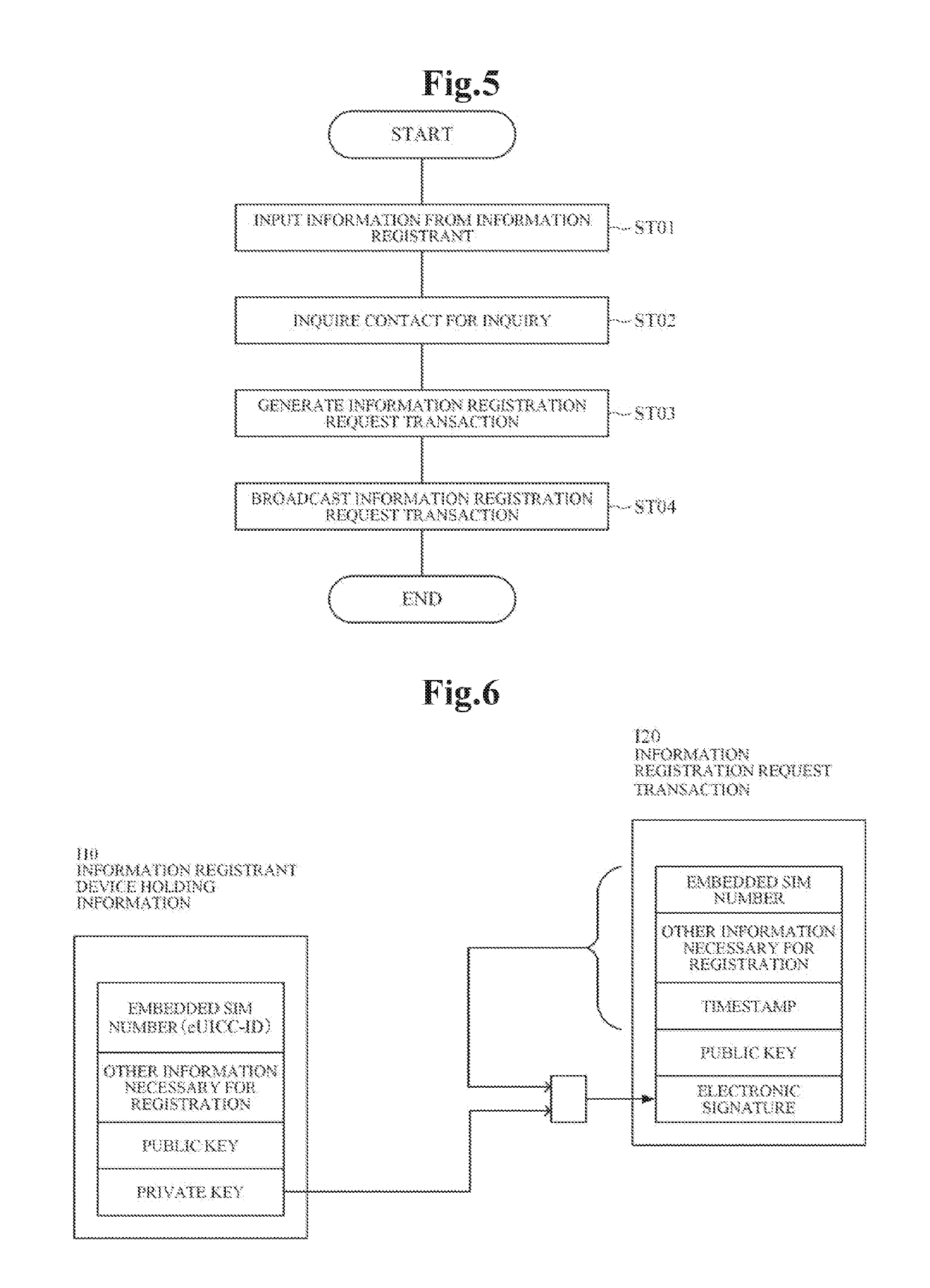

Embedded sim management system, node device, embedded sim management method, program, and information registrant device

ActiveUS20190289454A1Key distribution for secure communicationDigital data information retrievalComputer moduleSubscriber identity module

A node device configuring a peer-to-peer network includes: a network interface; and a blockchain management part configured to receive, through the network interface, an information registration request transaction that includes embedded Subscriber Identity Module, SIM, information including SIM identification information, an electronic signature put on the embedded SIM information by using a private key of an information registrant, and a public key paired with the private key, and accumulate the received information registration request transaction into a blockchain based on a consensus building algorithm executed in cooperation with another node device configuring the peer-to-peer network.

Owner:NEC CORP

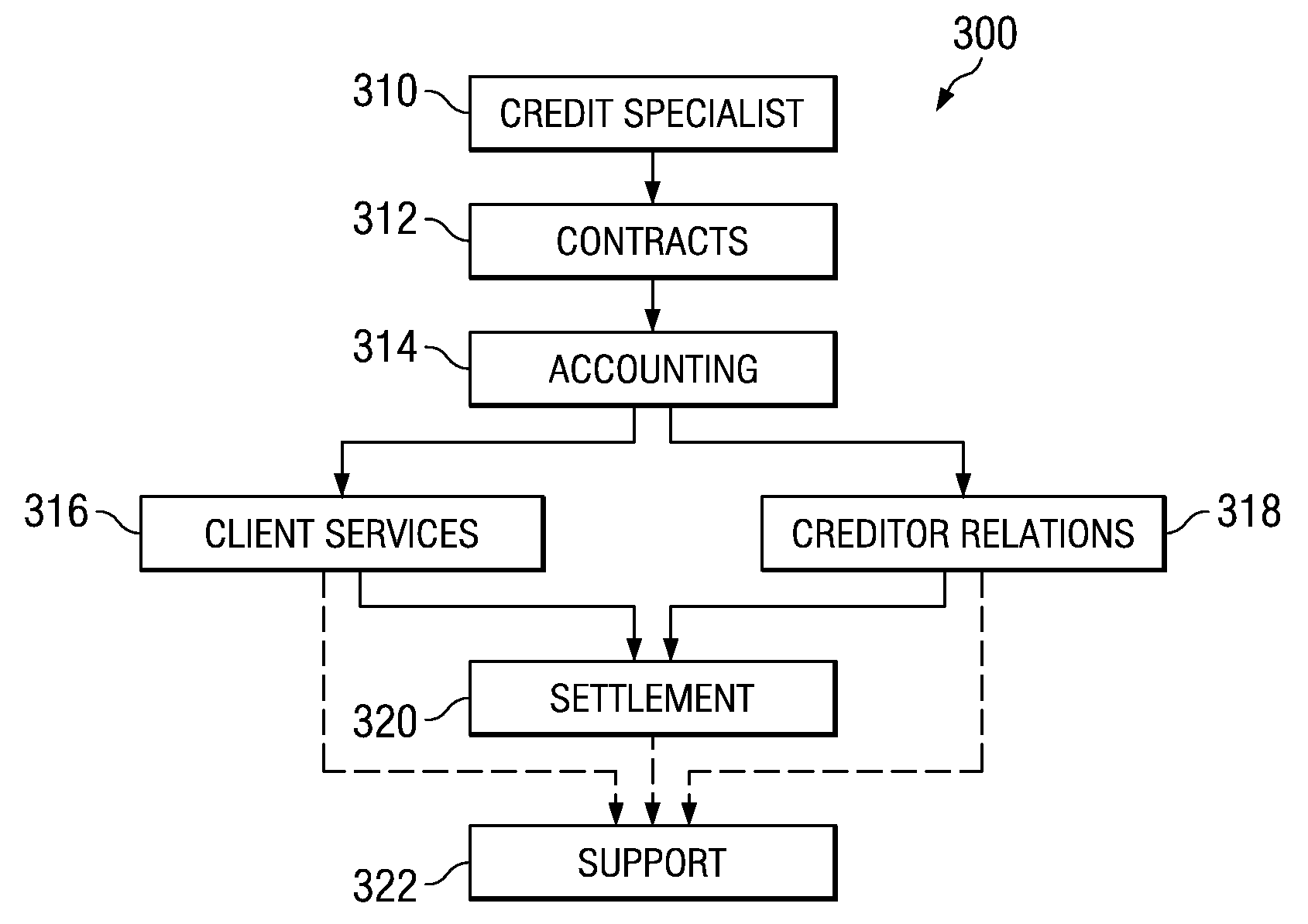

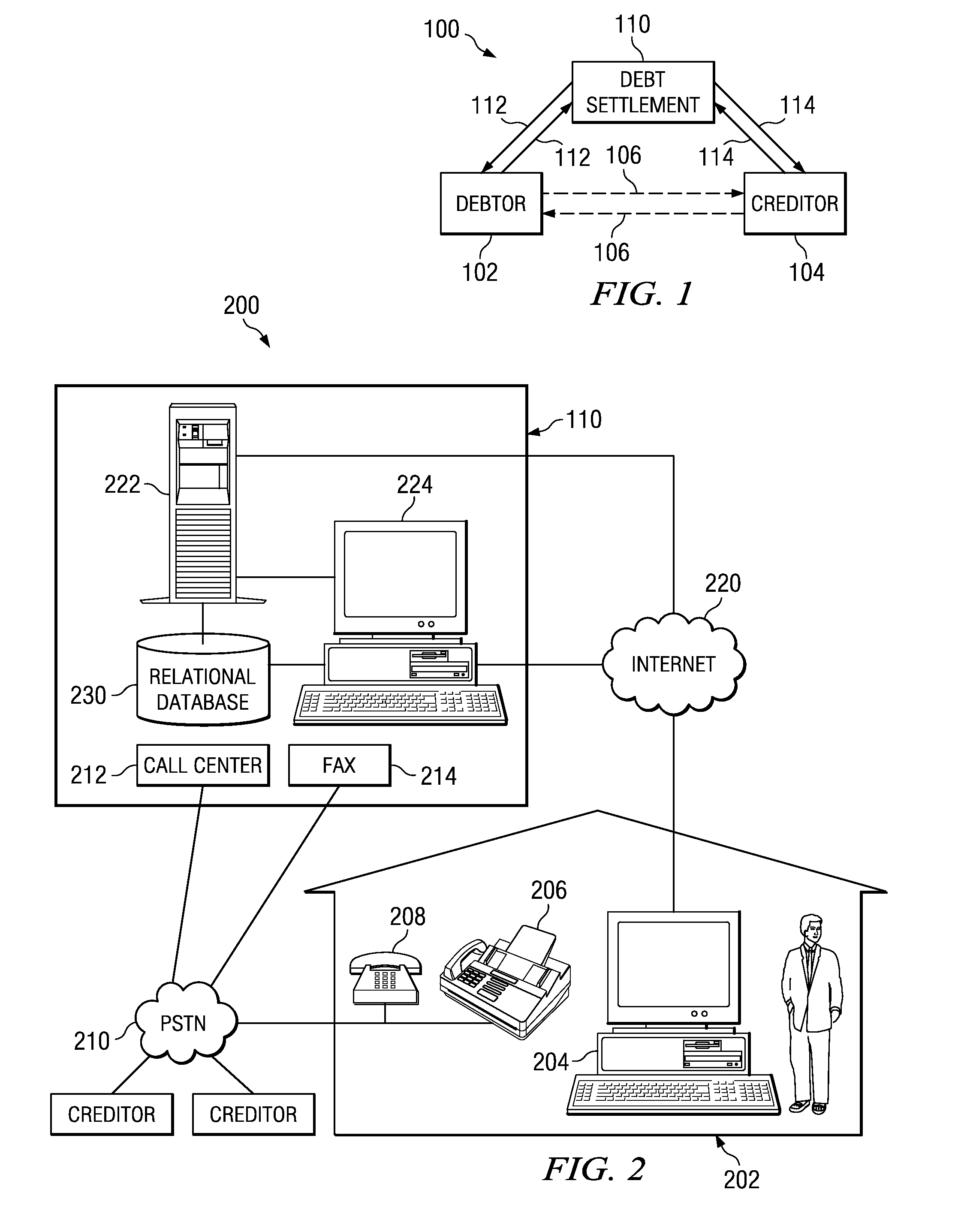

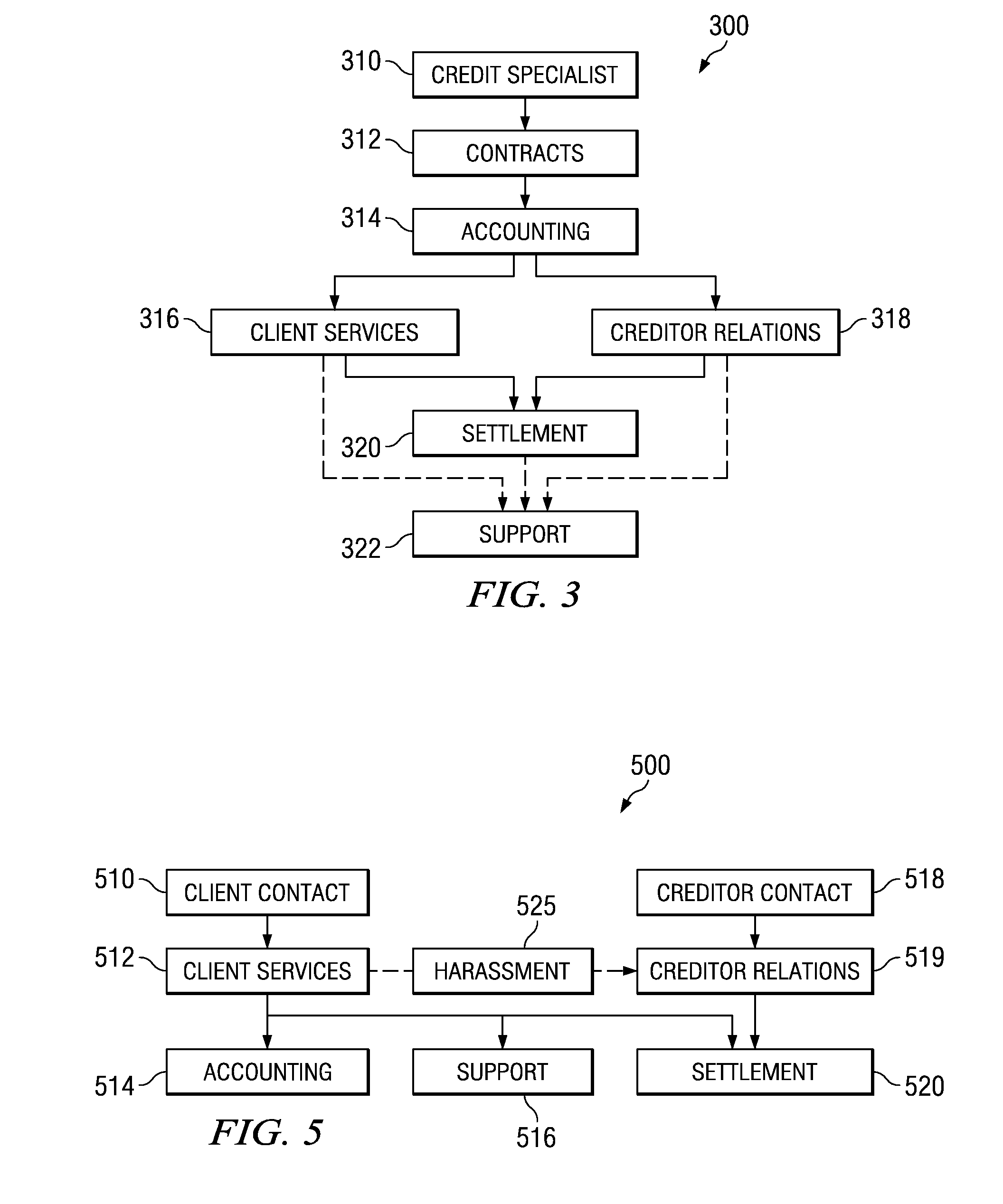

Computerized credit services information management system

A method of processing online applications is disclosed. The method includes receiving a customer contact lead, contacting the customer to obtain application data, preparing an application using the application data, and delivering the application to the customer. An electronic signature is accepted for completion of the application.

Owner:CSA CREDIT SOLUTIONS OF AMERICA

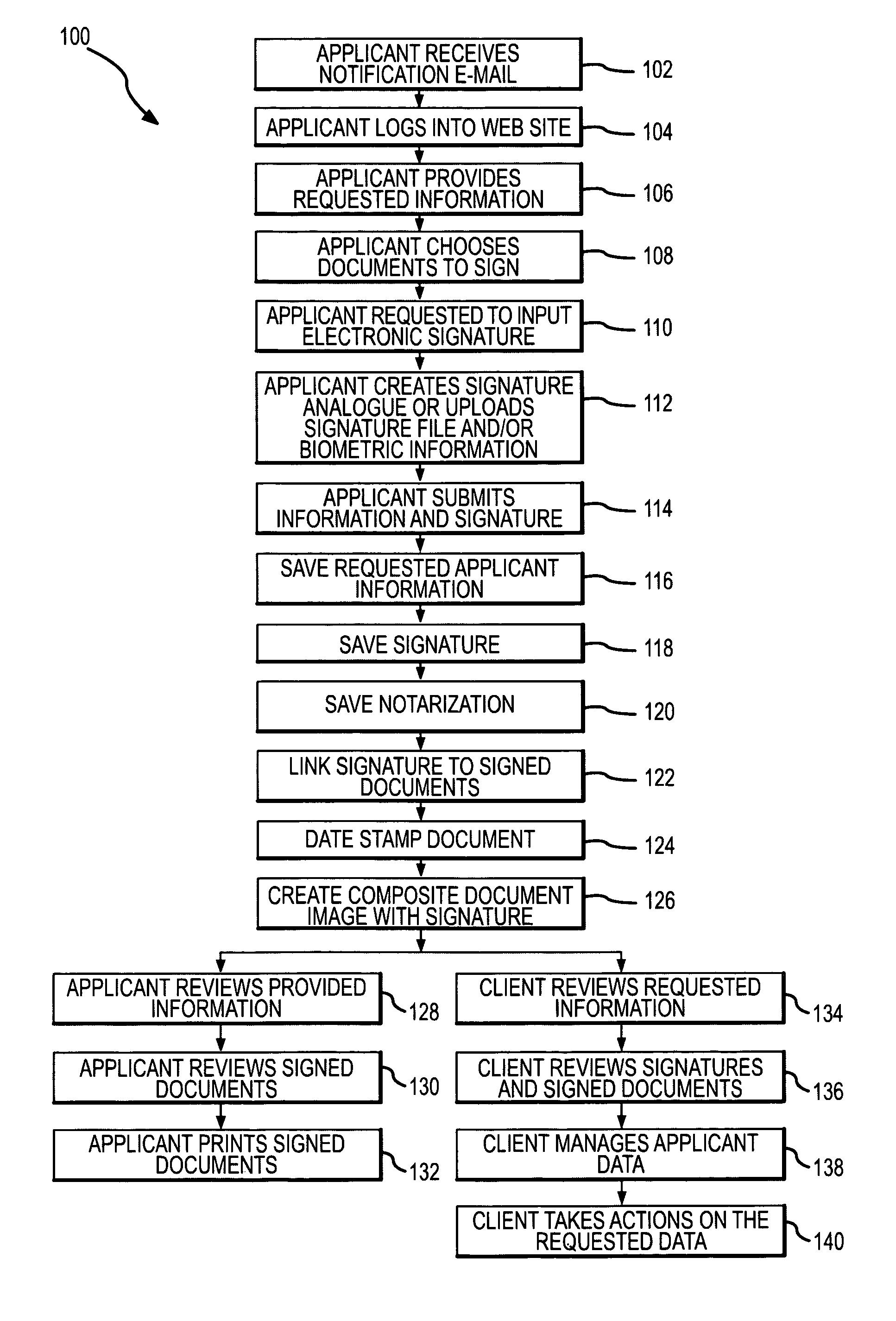

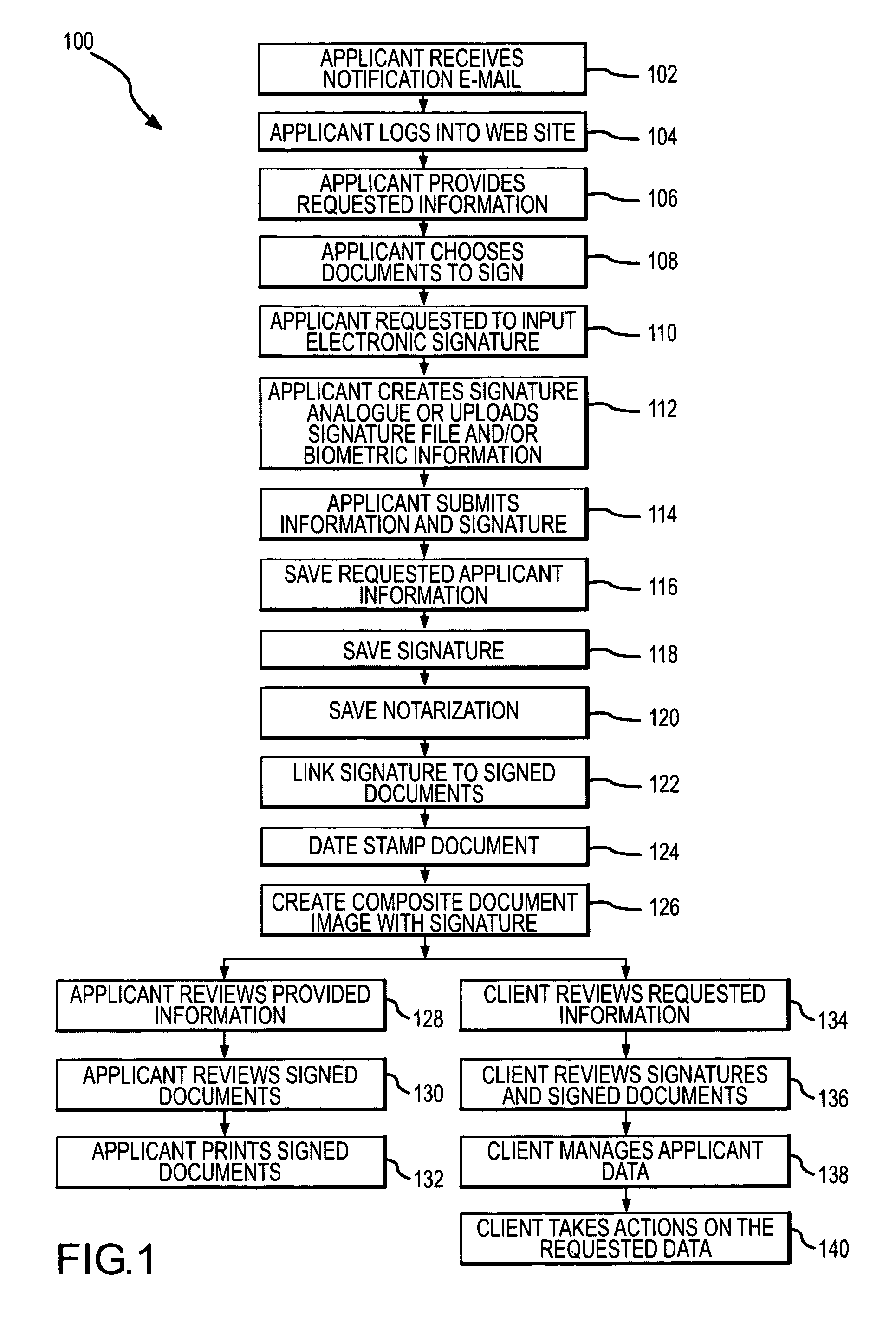

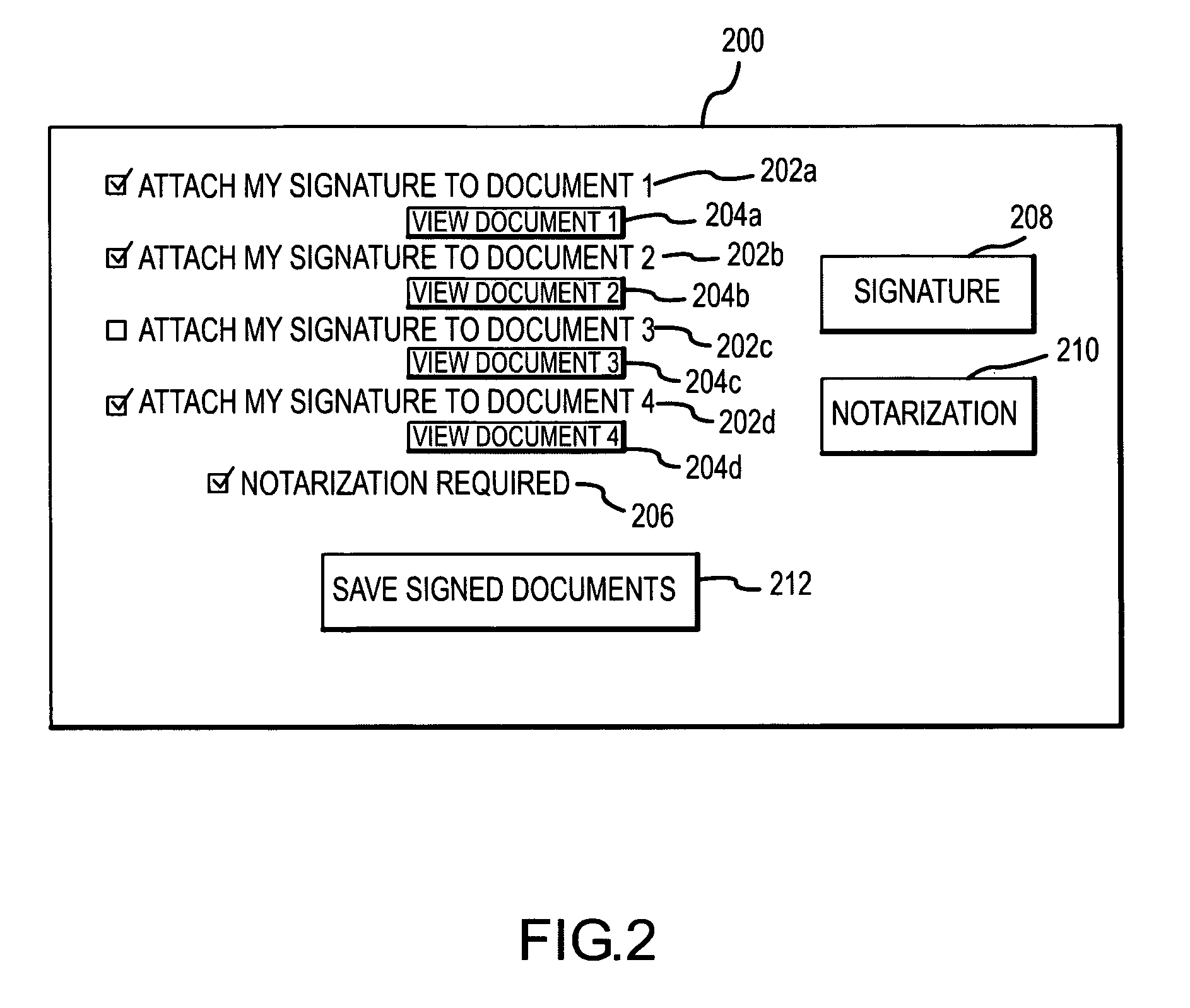

System and method for capturing and applying a legal signature to documents over a network

ActiveUS7934098B1Simple and convenient electronic capture and storage and transmissionEquivalent acceptabilityUser identity/authority verificationDigital data protectionGraphicsDocumentation procedure

An electronic signature capture system and process meets the legal requirements of a valid electronic signature while also providing electronically signed documents that have the appearance, and thus equivalent acceptability, of a traditional pen-and-ink signature. The documents can be signed using a mouse, a stylus, a touch screen, a graphics tablet, or other suitable input device to draw a signature analogue on the screen similar to signing a paper document with a pen. A fingerprint image, retinal scan image, or other similar biometric input may be captured in addition to or instead of a signature. The signature analogue is saved and linked to a particular user and to particular documents. The signature analogue may be combined with the document in a composite image file, or the signature analogue may be applied dynamically to appropriate document components to assemble an executed document as needed.

Owner:STERLING INFOSYST INC

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com