Patents

Literature

60 results about "Automated Clearing House" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

An automated clearing house (ACH), or automated clearinghouse, is an electronic network for financial transactions, generally domestic low value payments. An ACH is a computer-based clearing house and settlement facility established to process the exchange of electronic transactions between participating financial institutions. It is a form of clearing house that is specifically for payments and may support both credit transfers and direct debits.

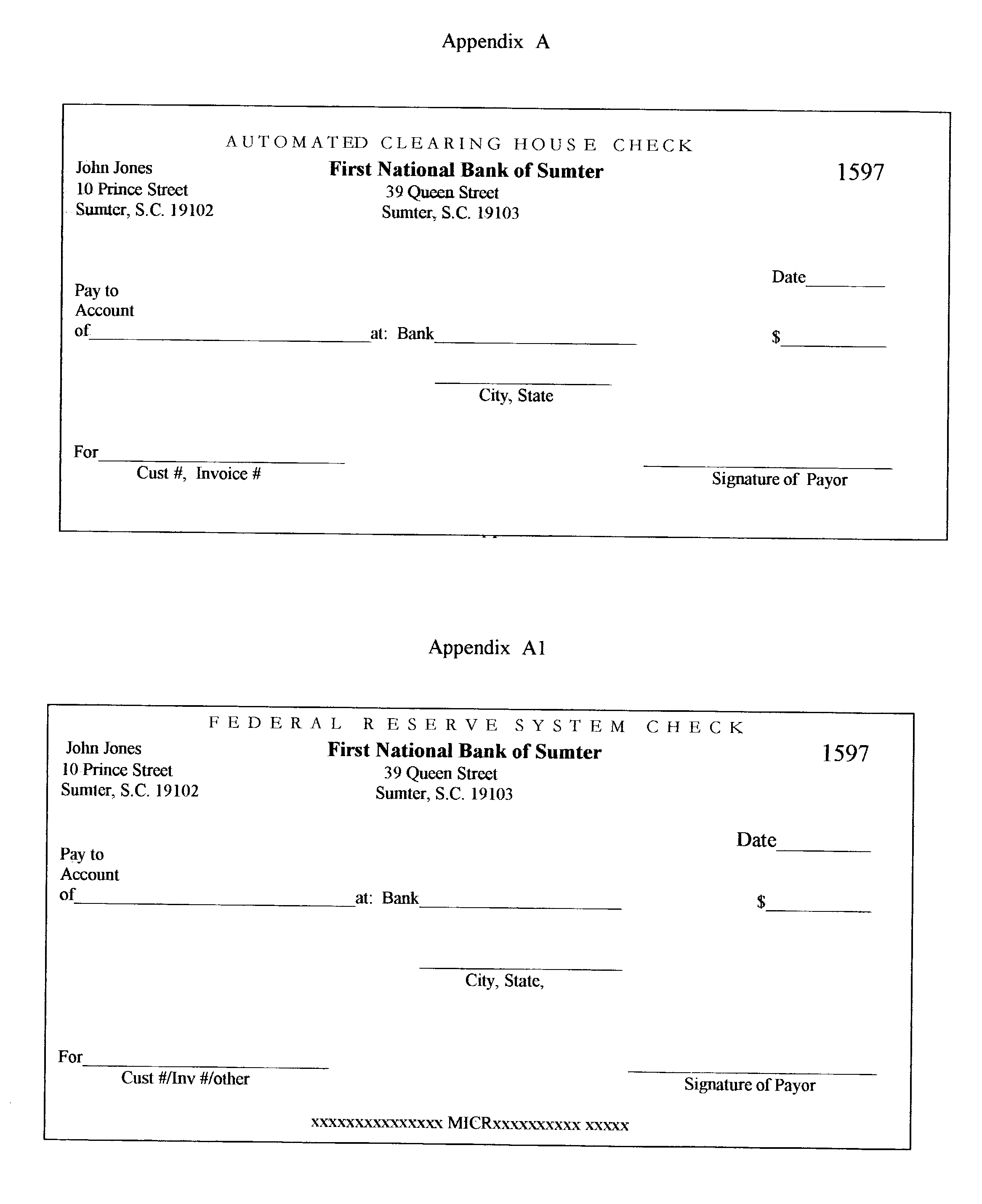

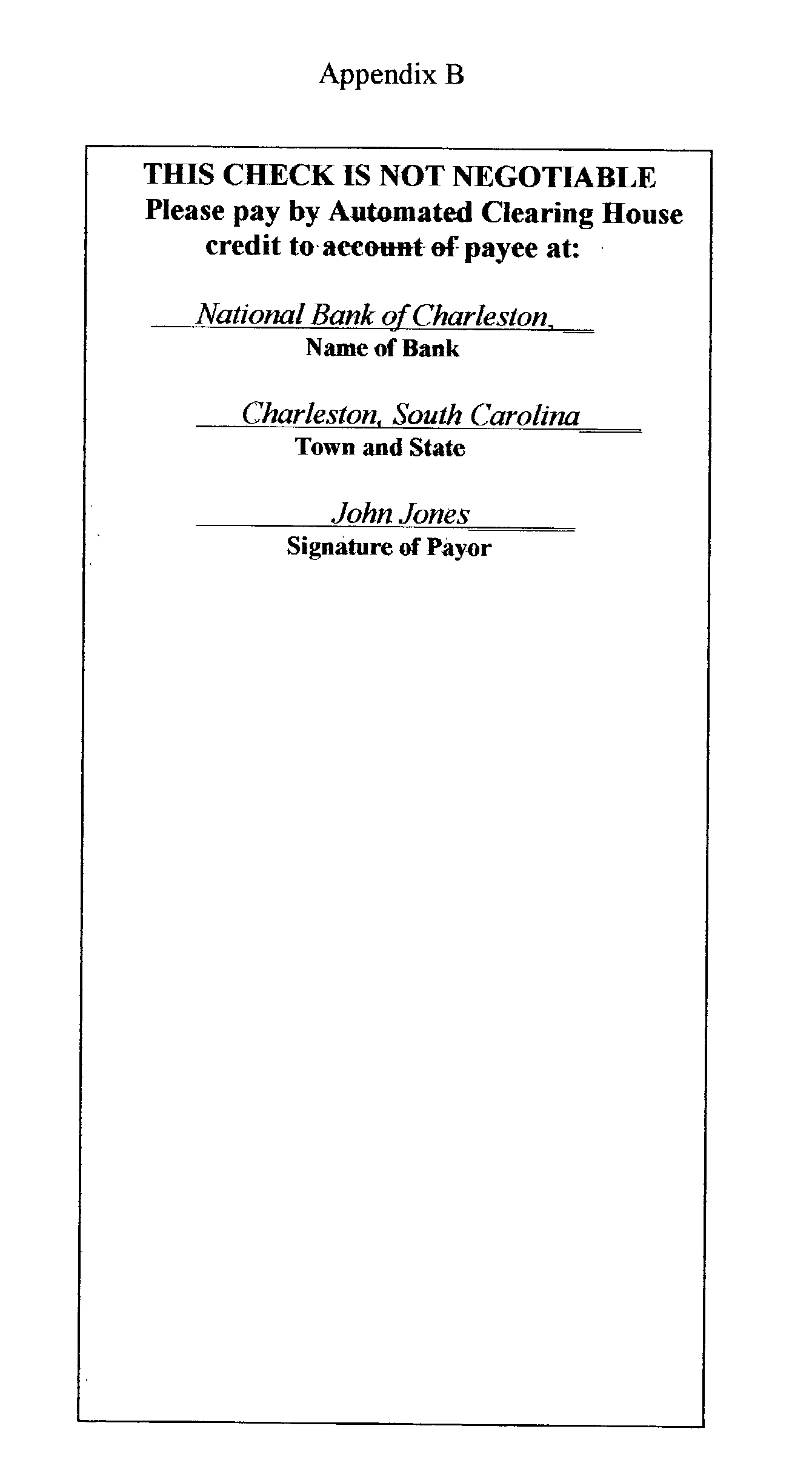

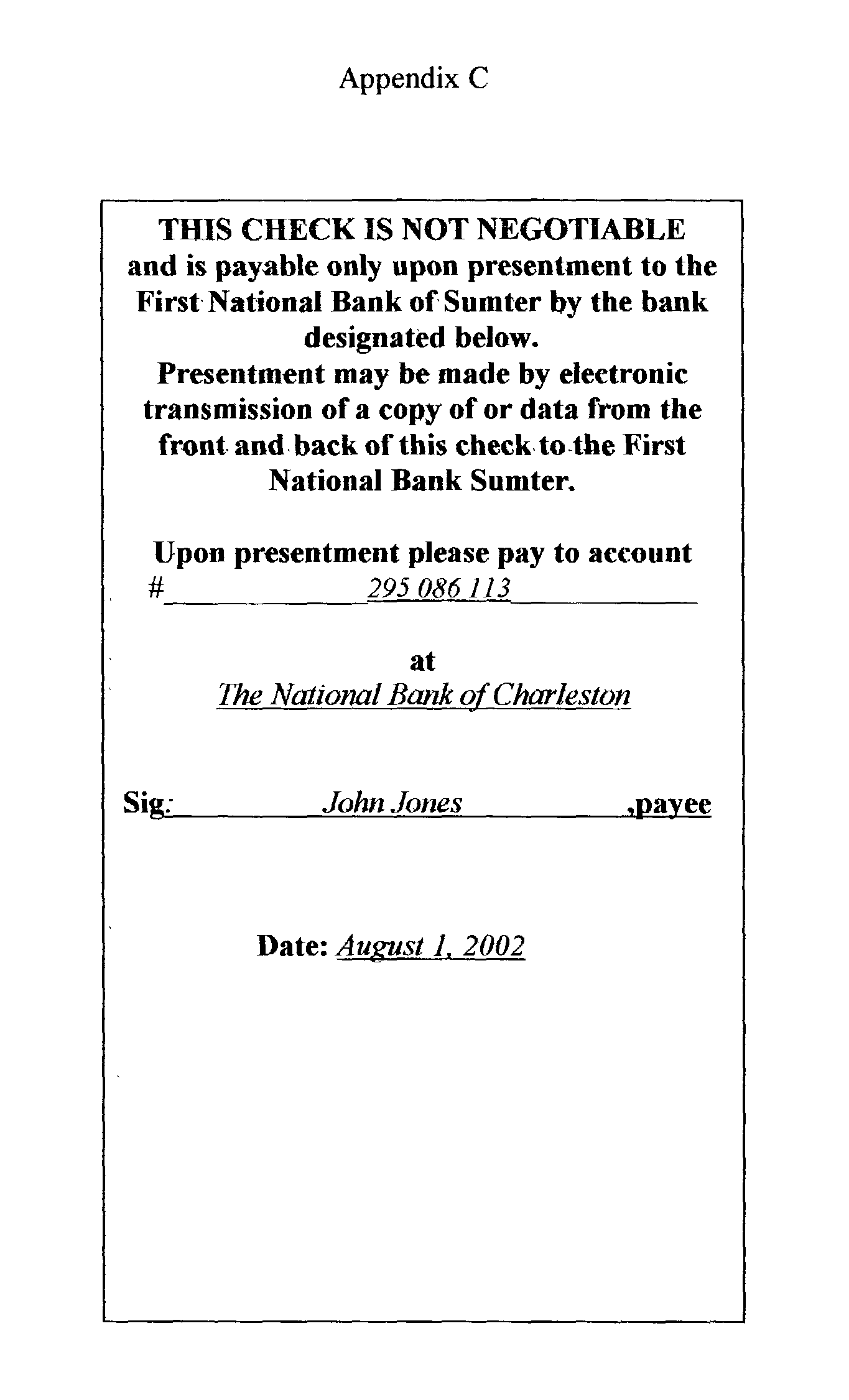

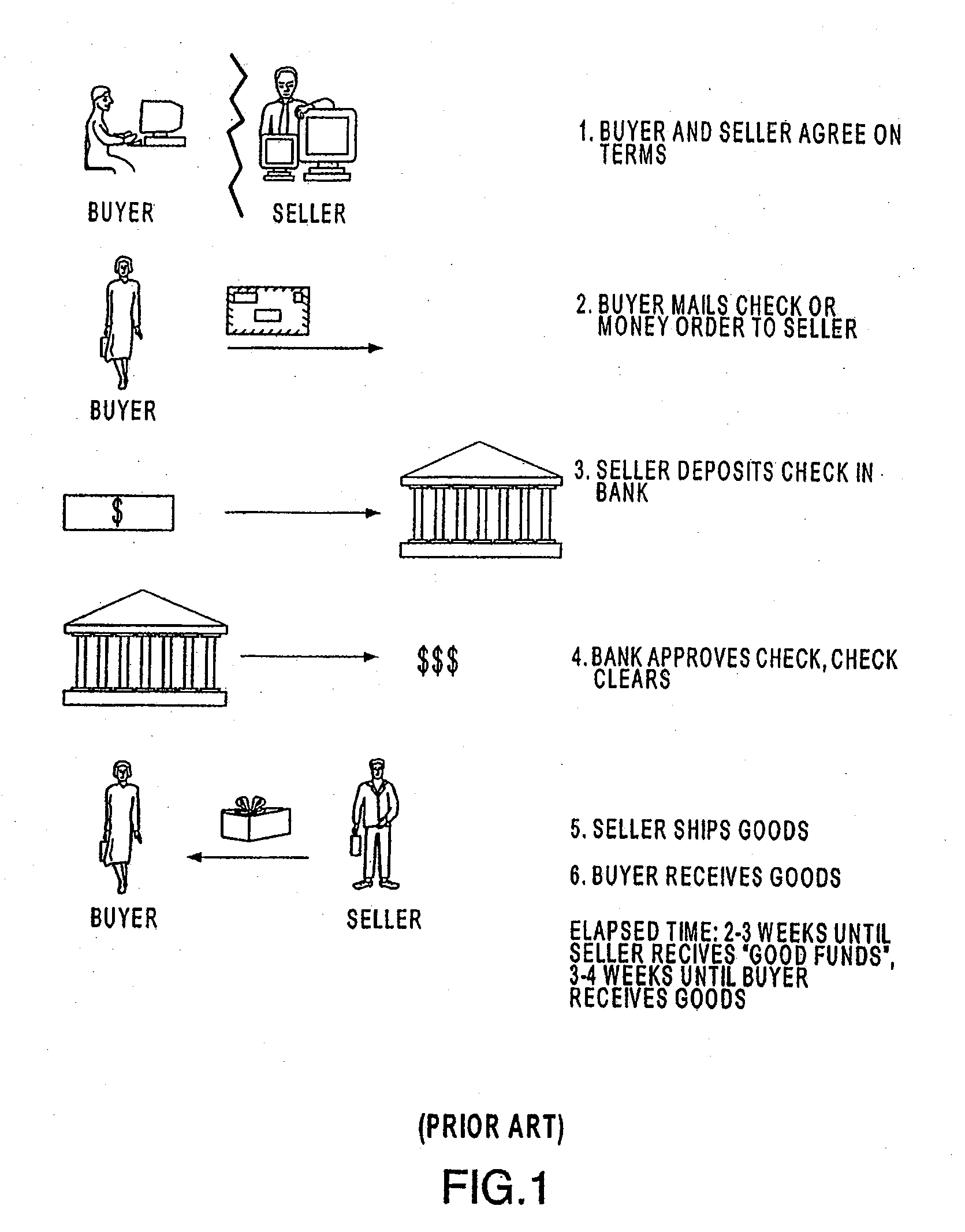

Method of making money payments

The system disclosed is for making payments using a new type of bank check combined with electronic funds transfer (EFT) facilities The new type check is not a negotiable instrument and is intended for delivery to the payor's bank rather than to the payee. The check instructs the payor's bank to make a payment by EFT from the payor's bank account directly to the bank account of the payee at the payee's bank, normally via the Federal Reserve's Automated Clearing House (ACH) facility. The system includes means for making a true, but inoperative, copy of each check at the time the check is written. Other embodiments of the invention are special checks, which look like conventional checks, but on their reverse sides display printed matter stating that they are non-negotiable and are payable only pursuant to special procedures.

Owner:ALLAN FREDERICK ALEY

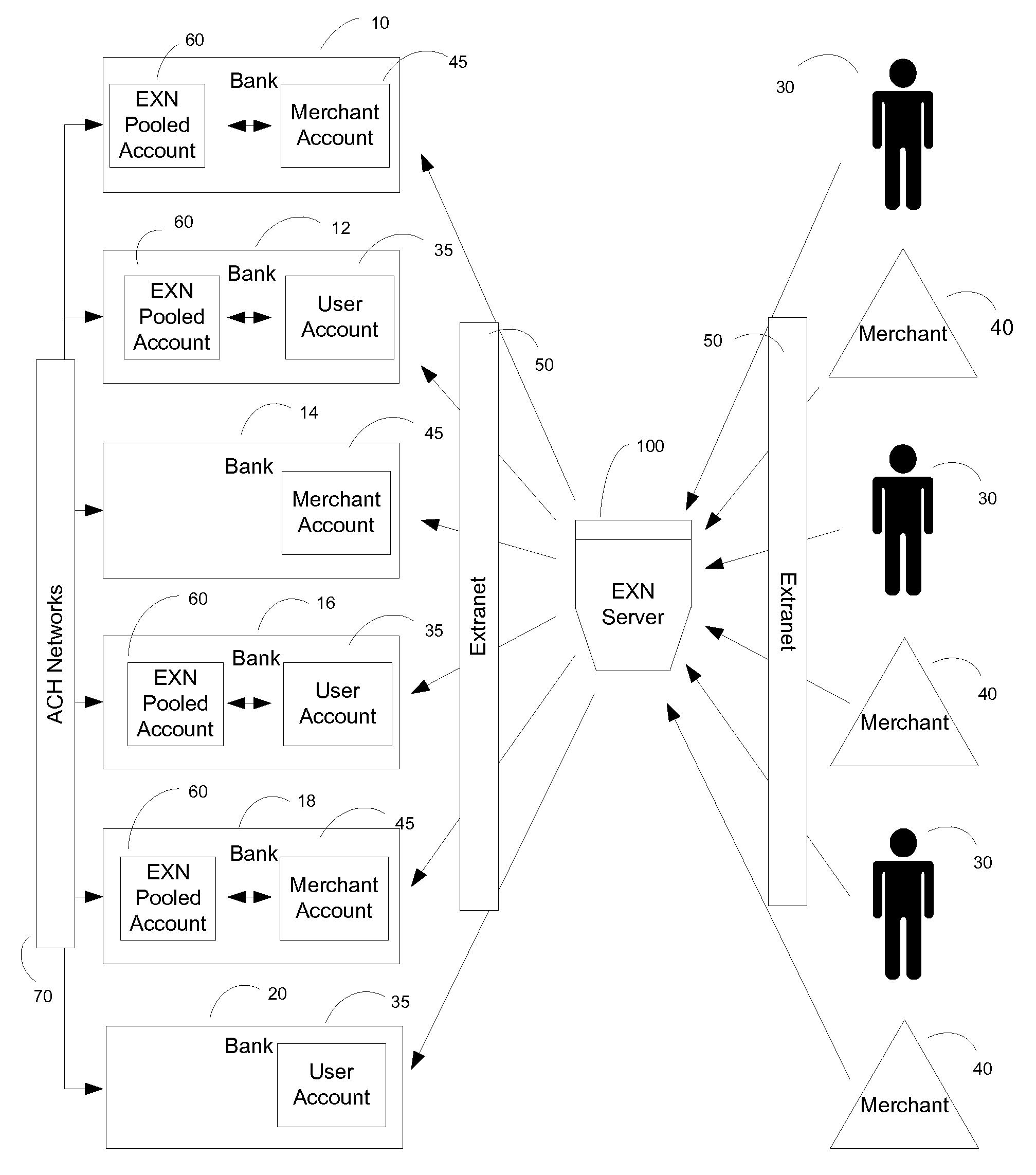

Method of making secure on-line financial transactions

InactiveUS20080046362A1Shorten the timeConvenient transactionFinancePayment circuitsCyber operationsThe Internet

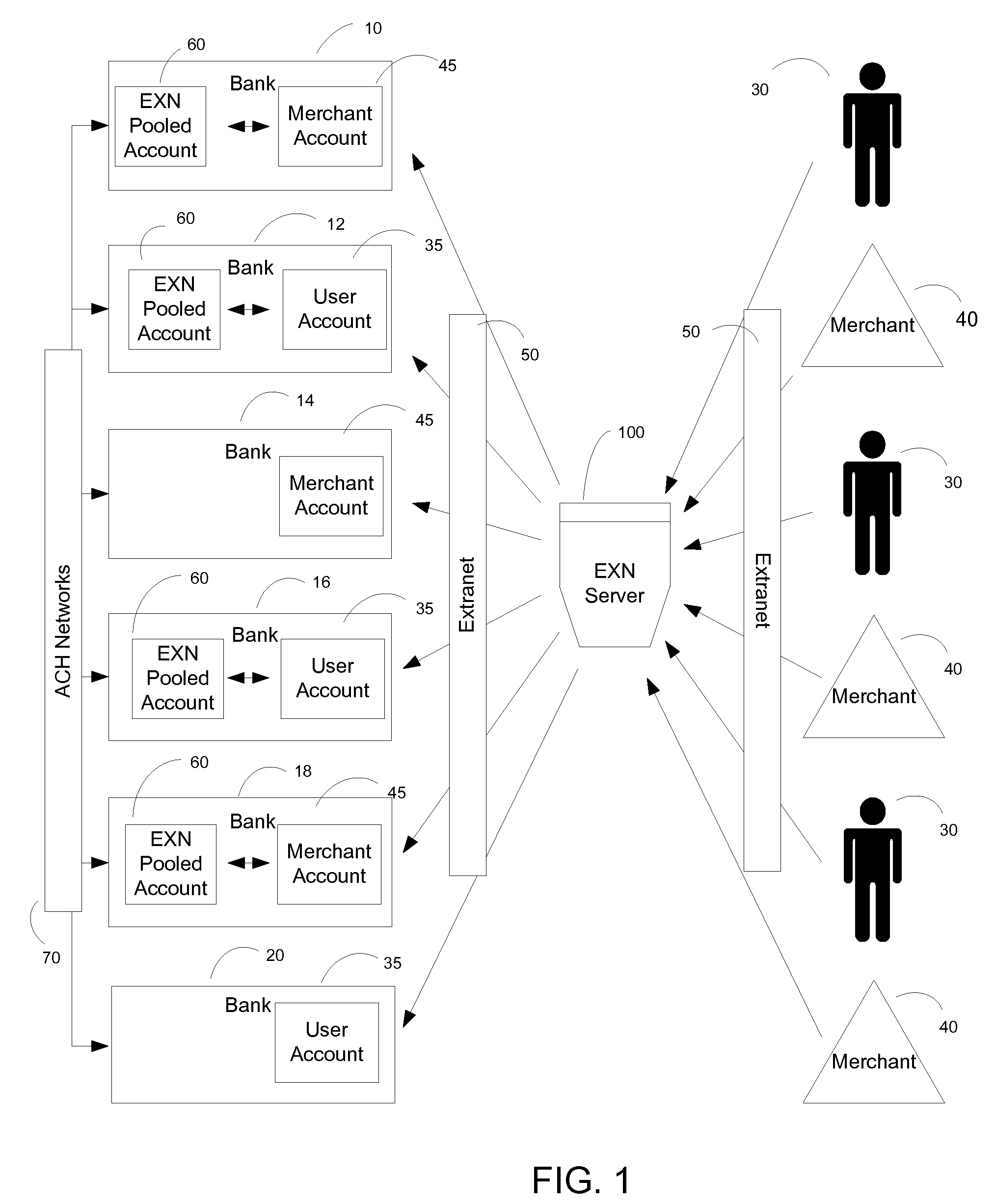

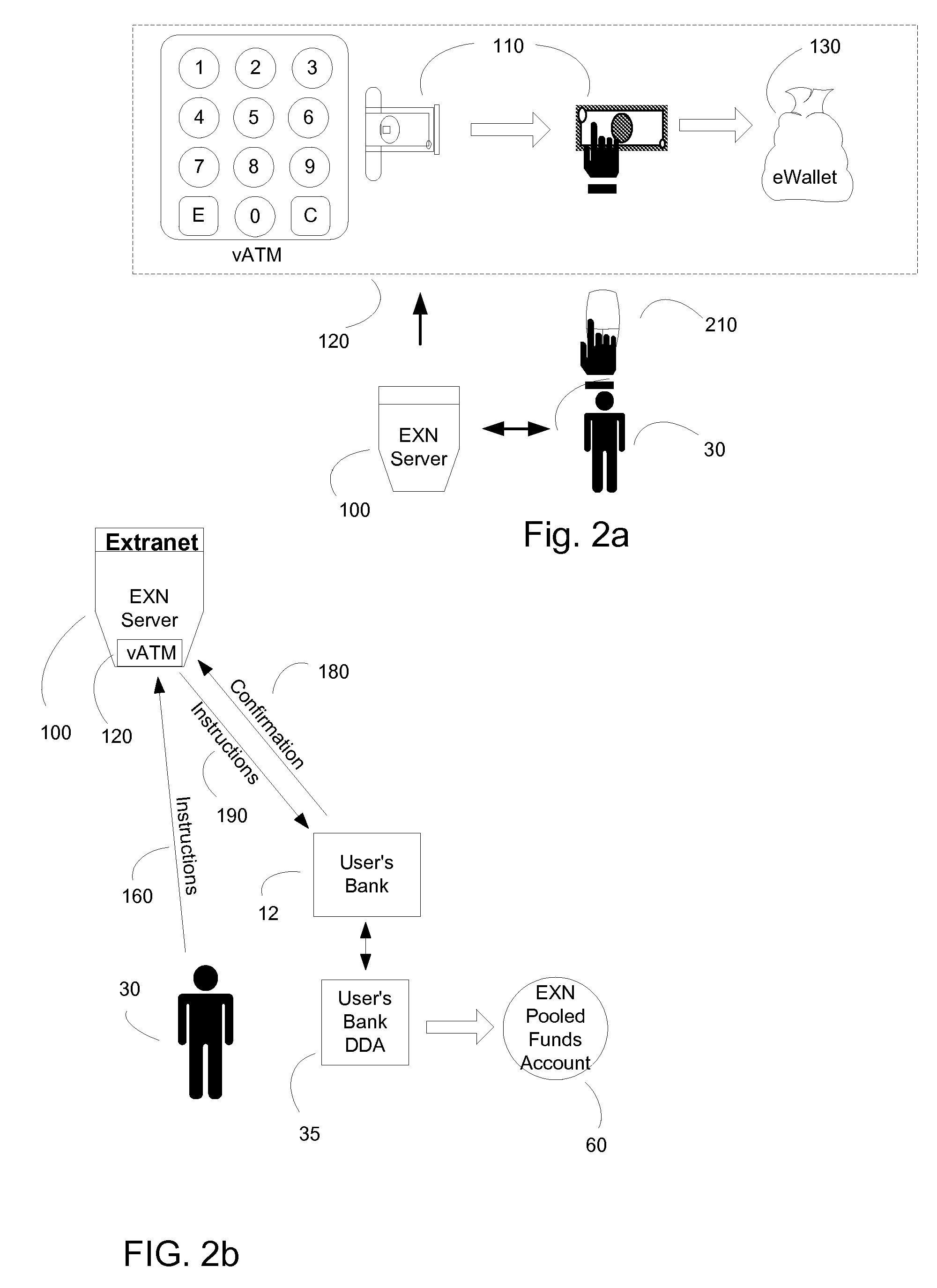

A method of providing secure financial transactions using the internet creates virtual currency that is used to settle monetary obligations amongst authorized purchasers, merchants, and other financial operators. The network operator maintains available funds in pooled fund accounts at various financial institutions, and uses those funds to purchase and sell virtual currency that may then be used on-line. Actual monetary transfers take place between pooled accounts using traditional automated clearing house (ACH) networks, pursuant to instructions provided to financial institutions by the network operator. User authentication and authorization are provided through a dual registration process, and a user's identity may be authenticated using a physical medium or a PIN. Instructions may be given remotely to the network operator through cellular telephones and PDAs.

Owner:EASTERLY FRANK

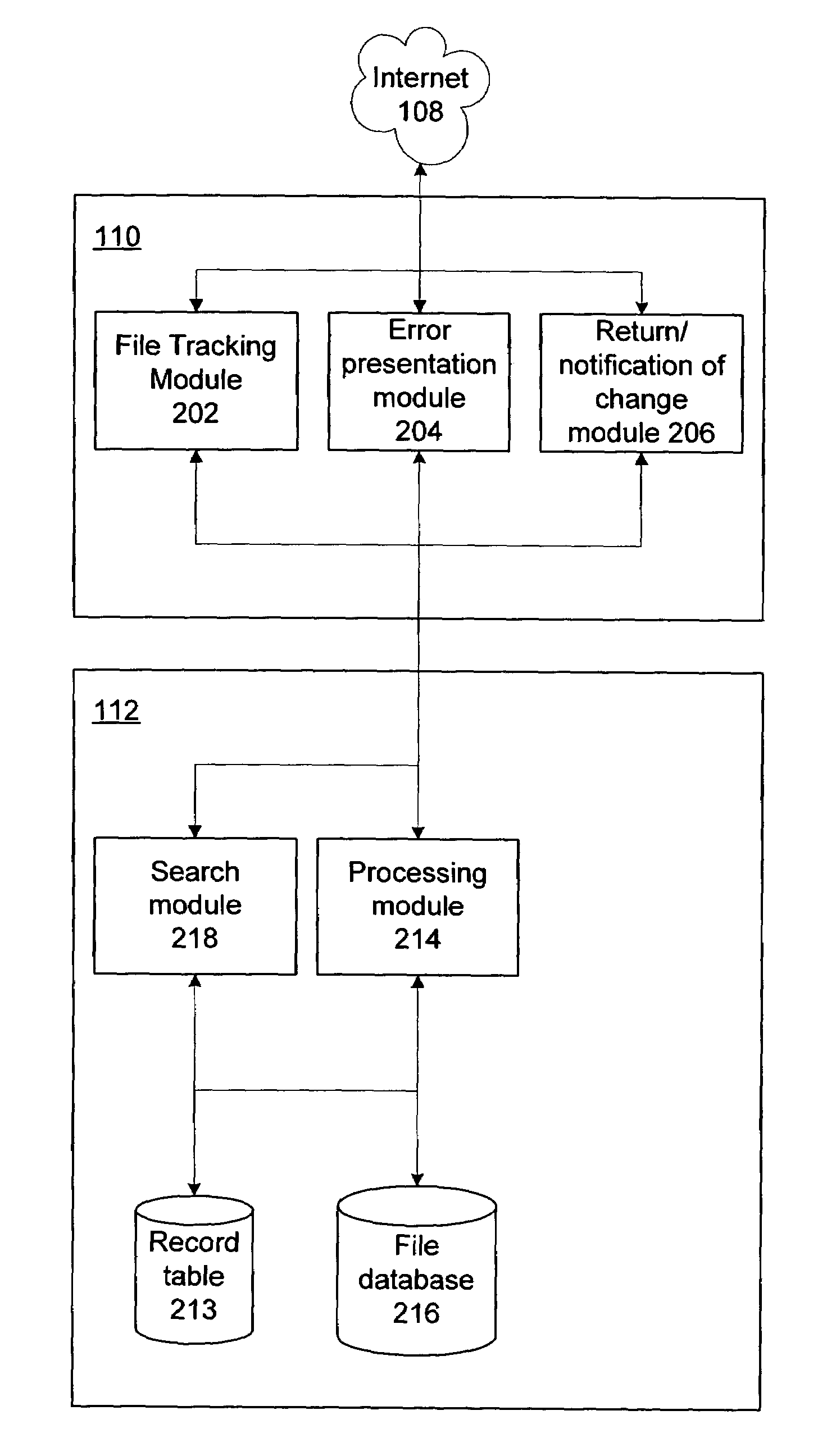

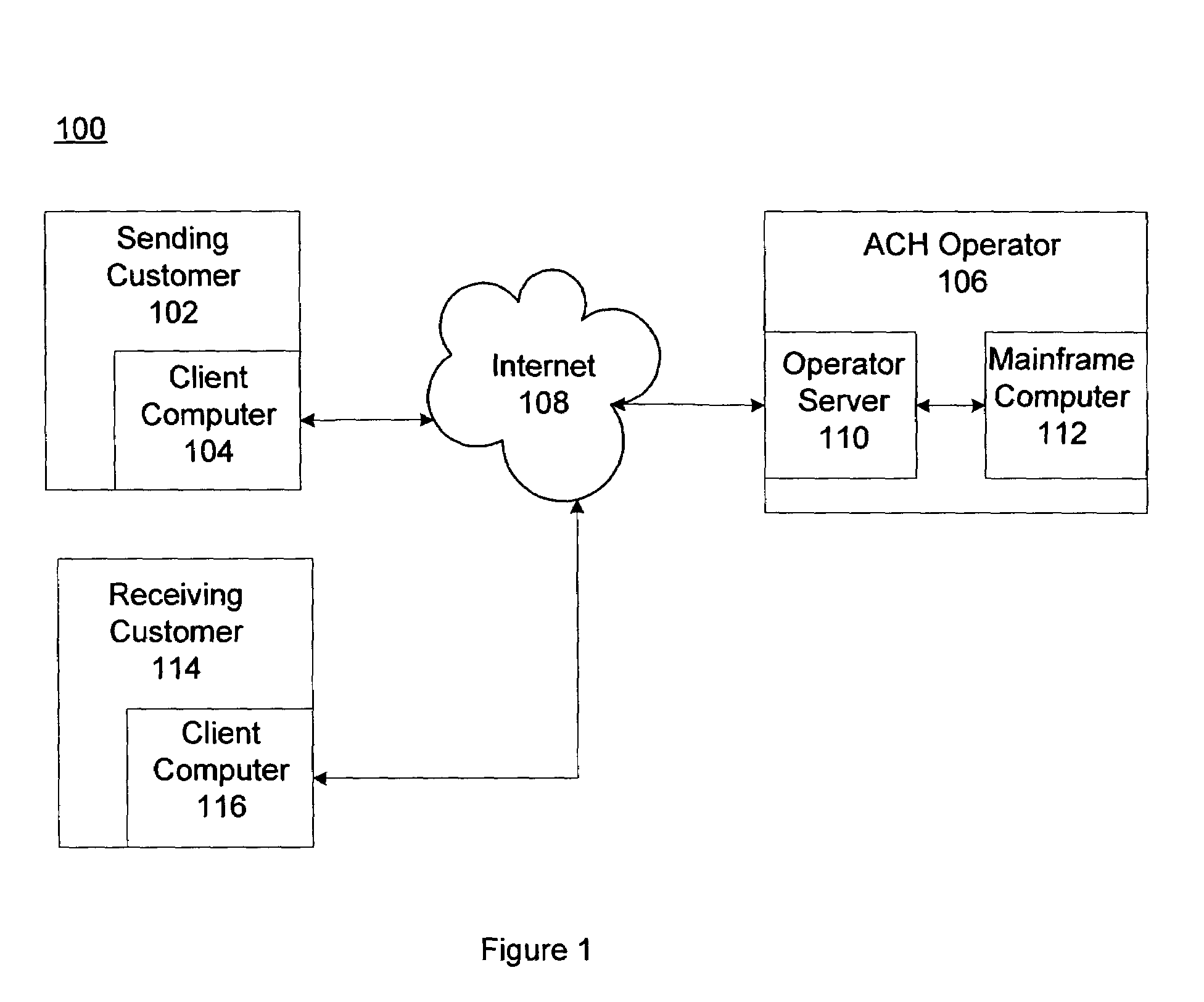

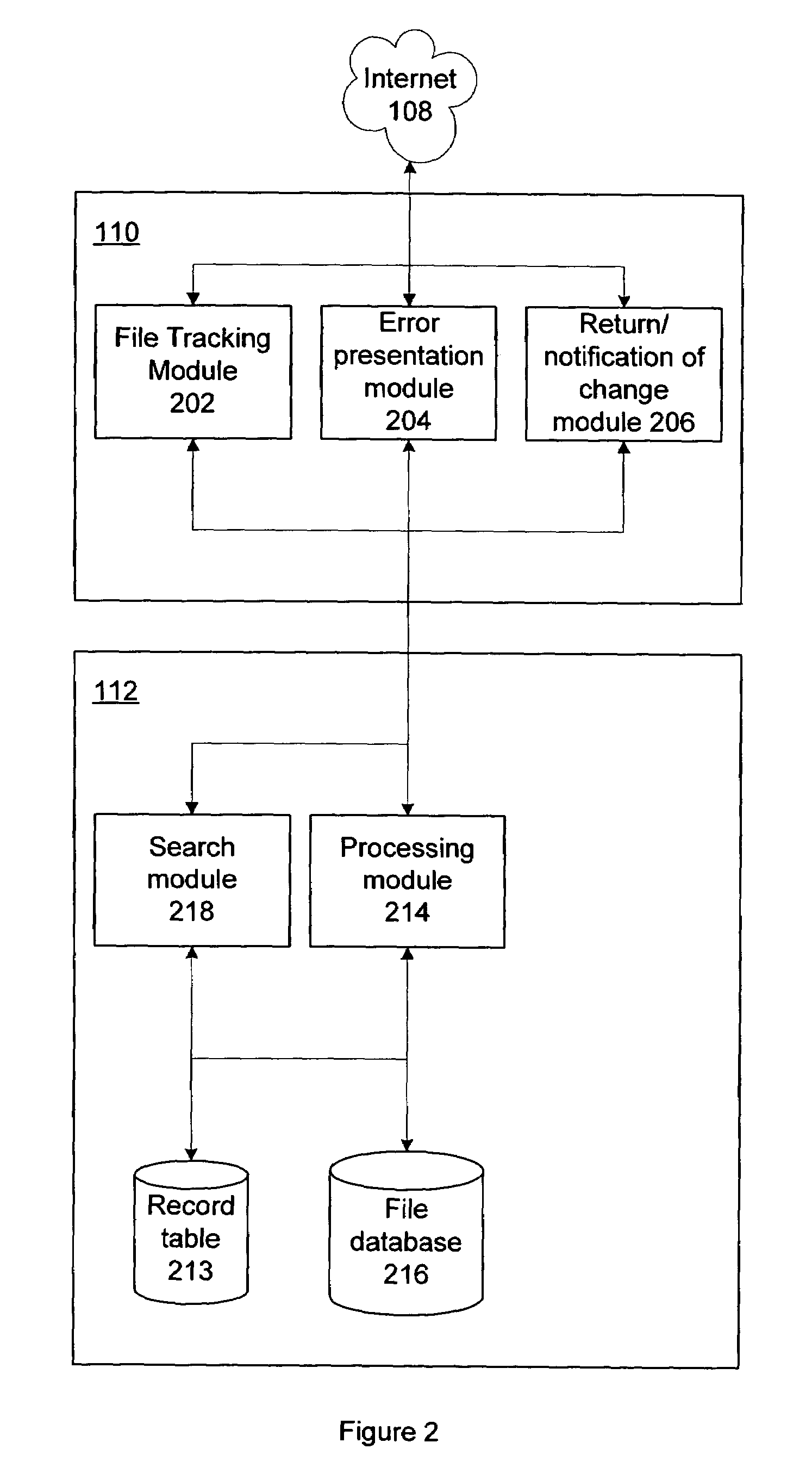

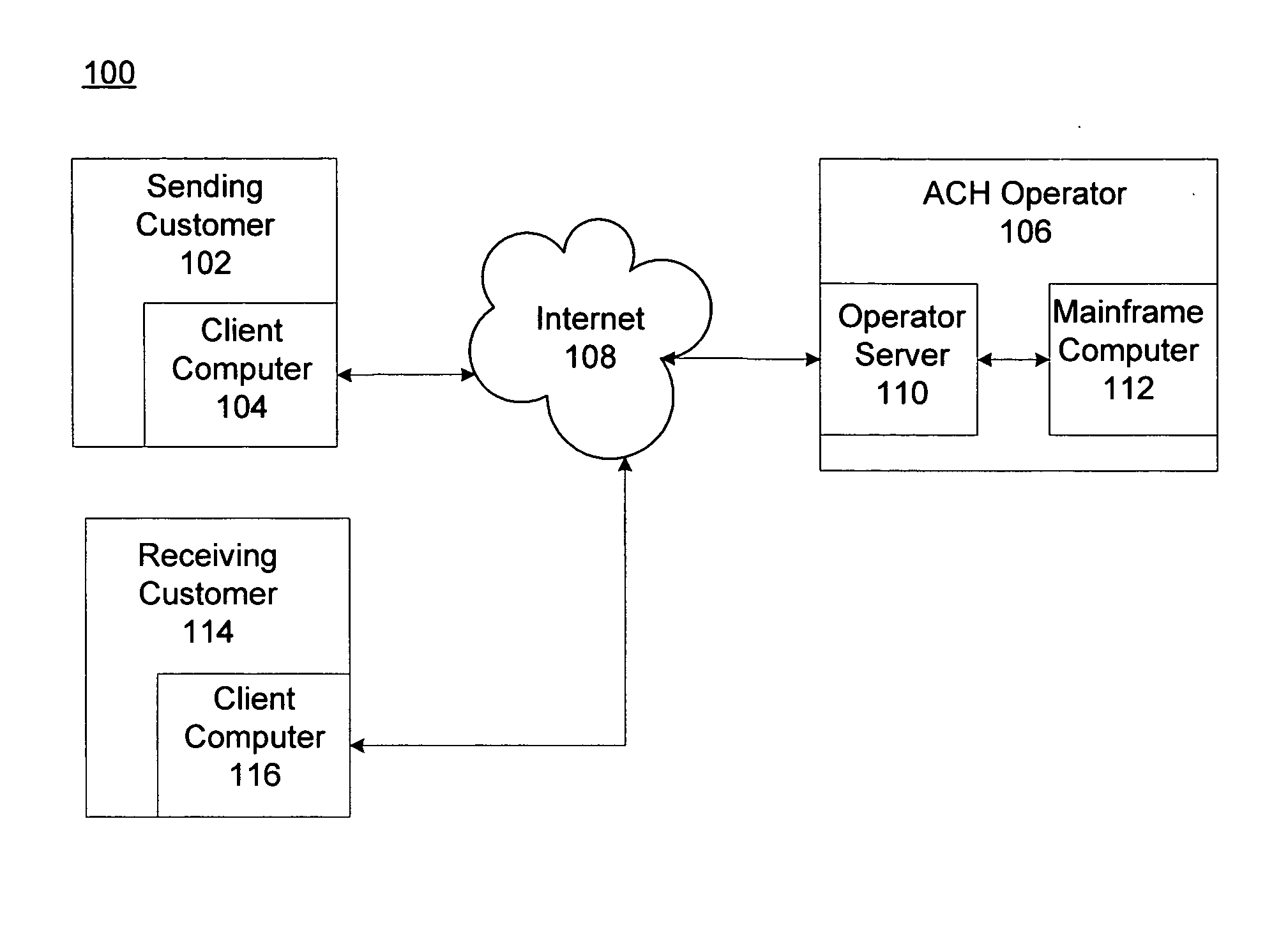

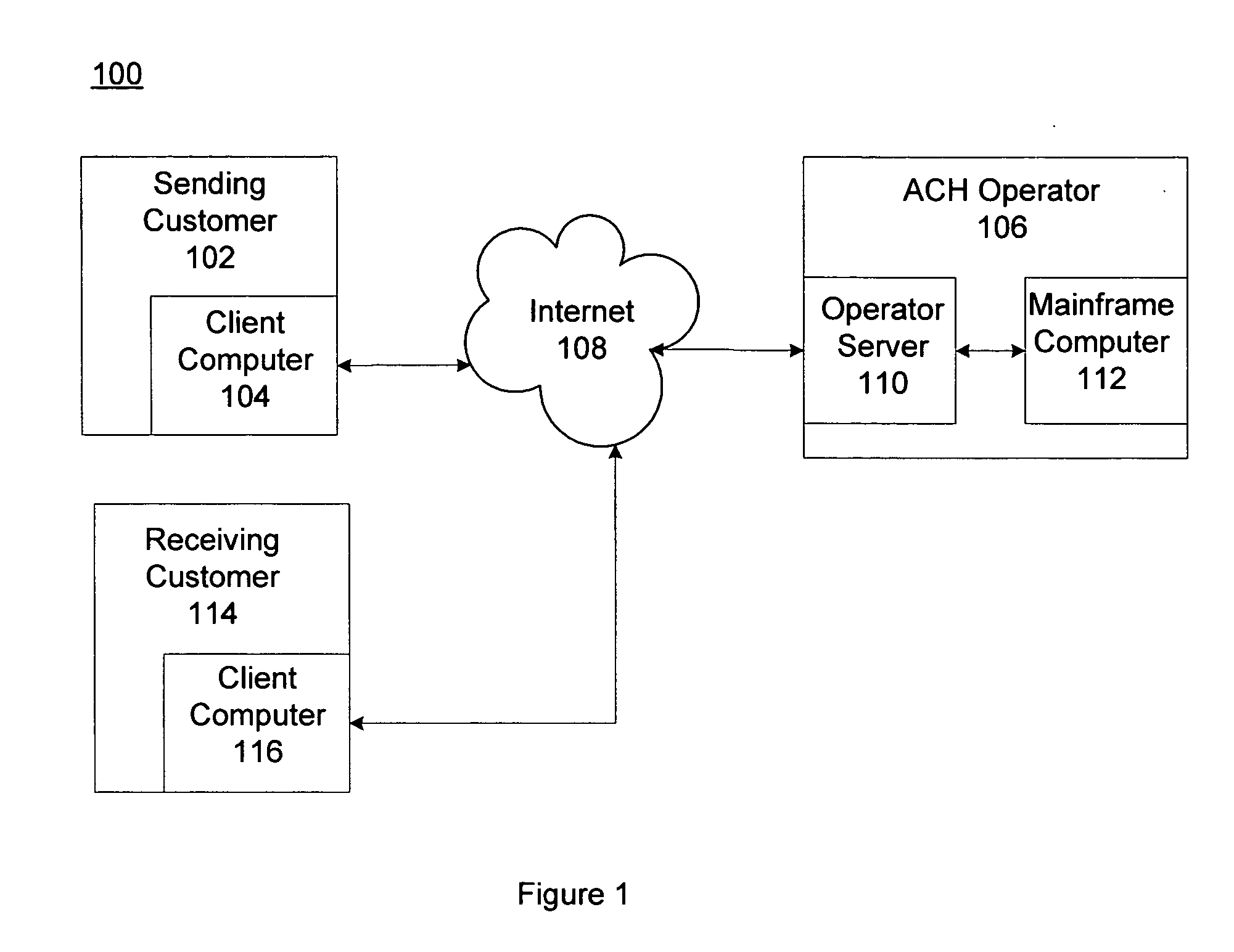

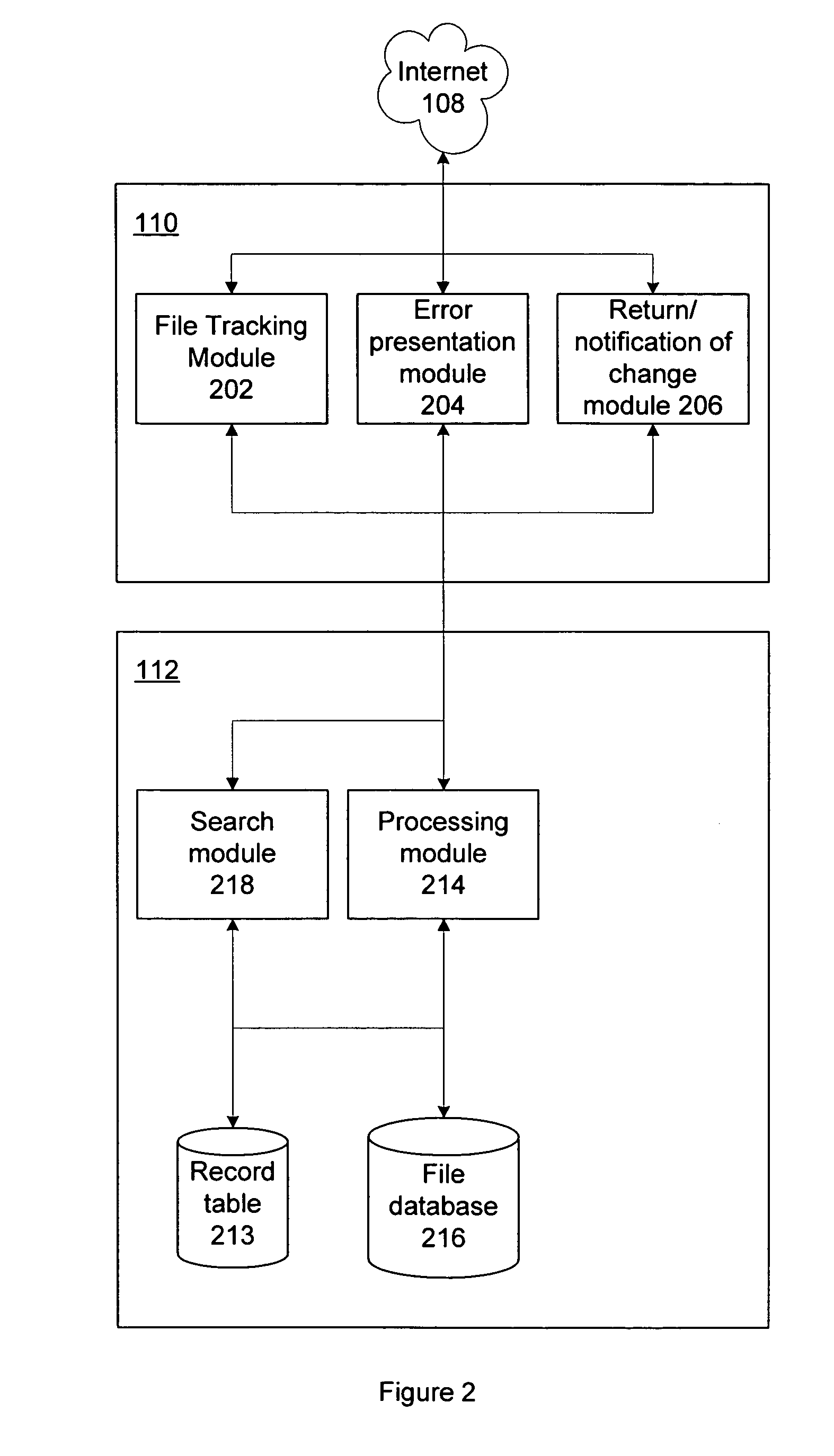

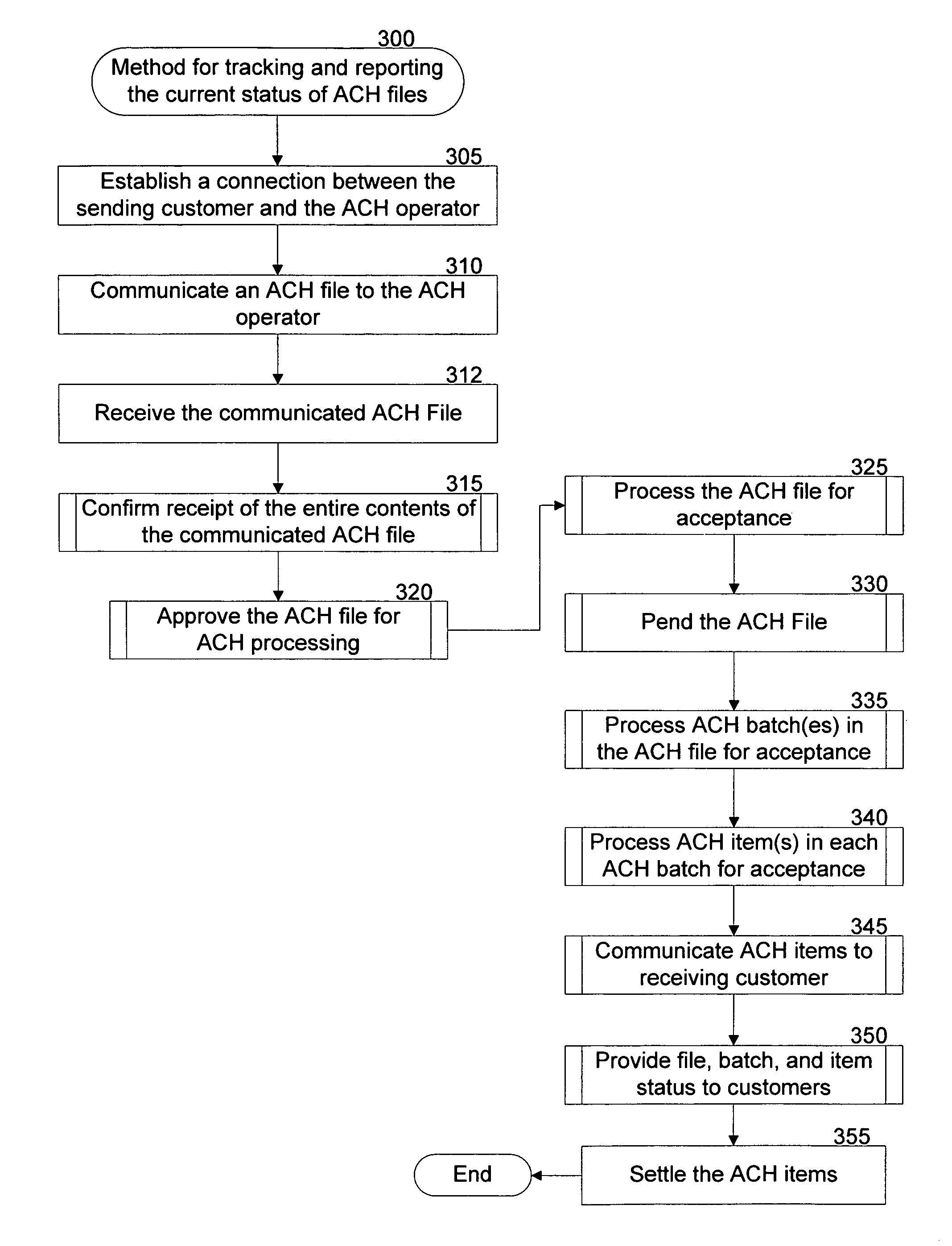

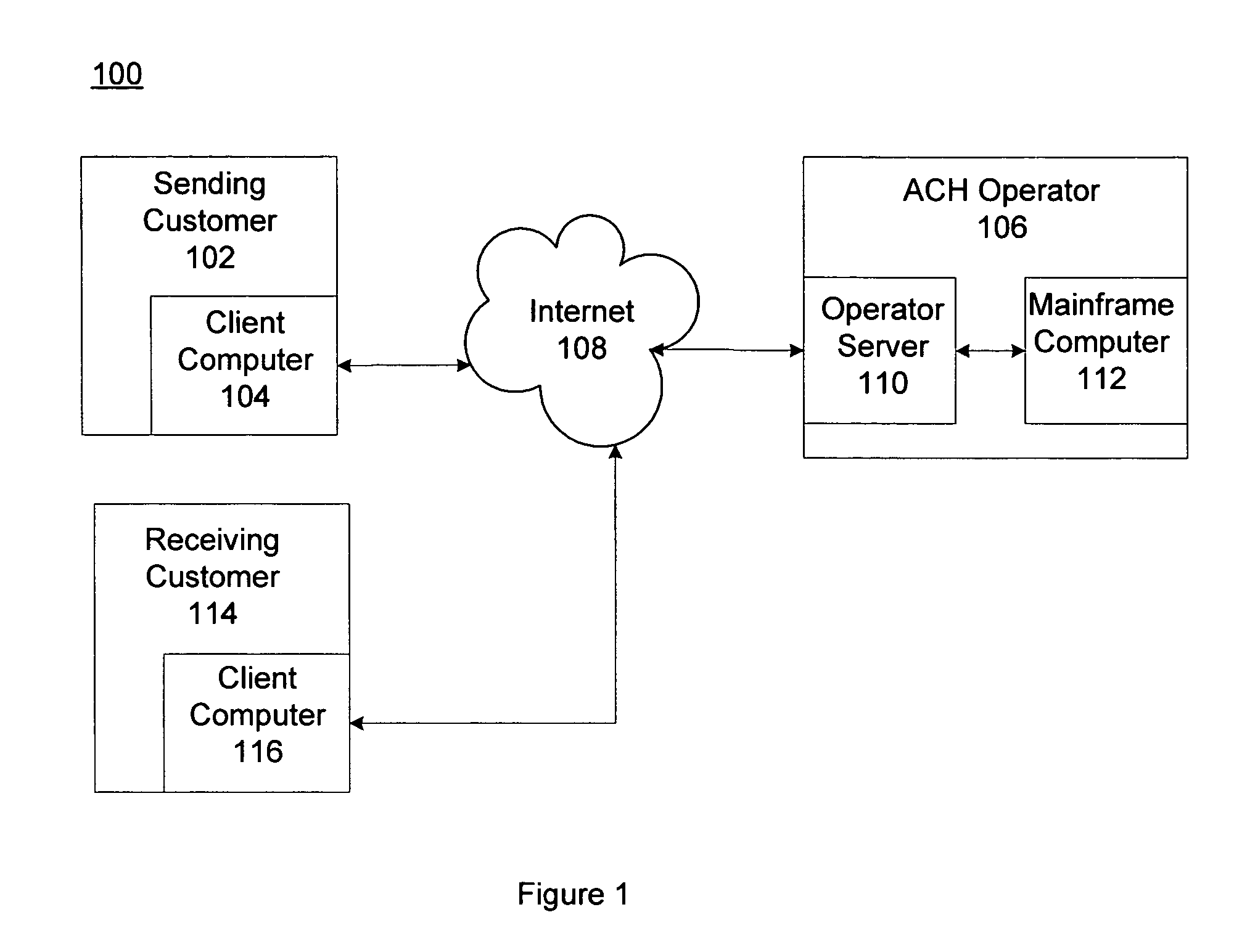

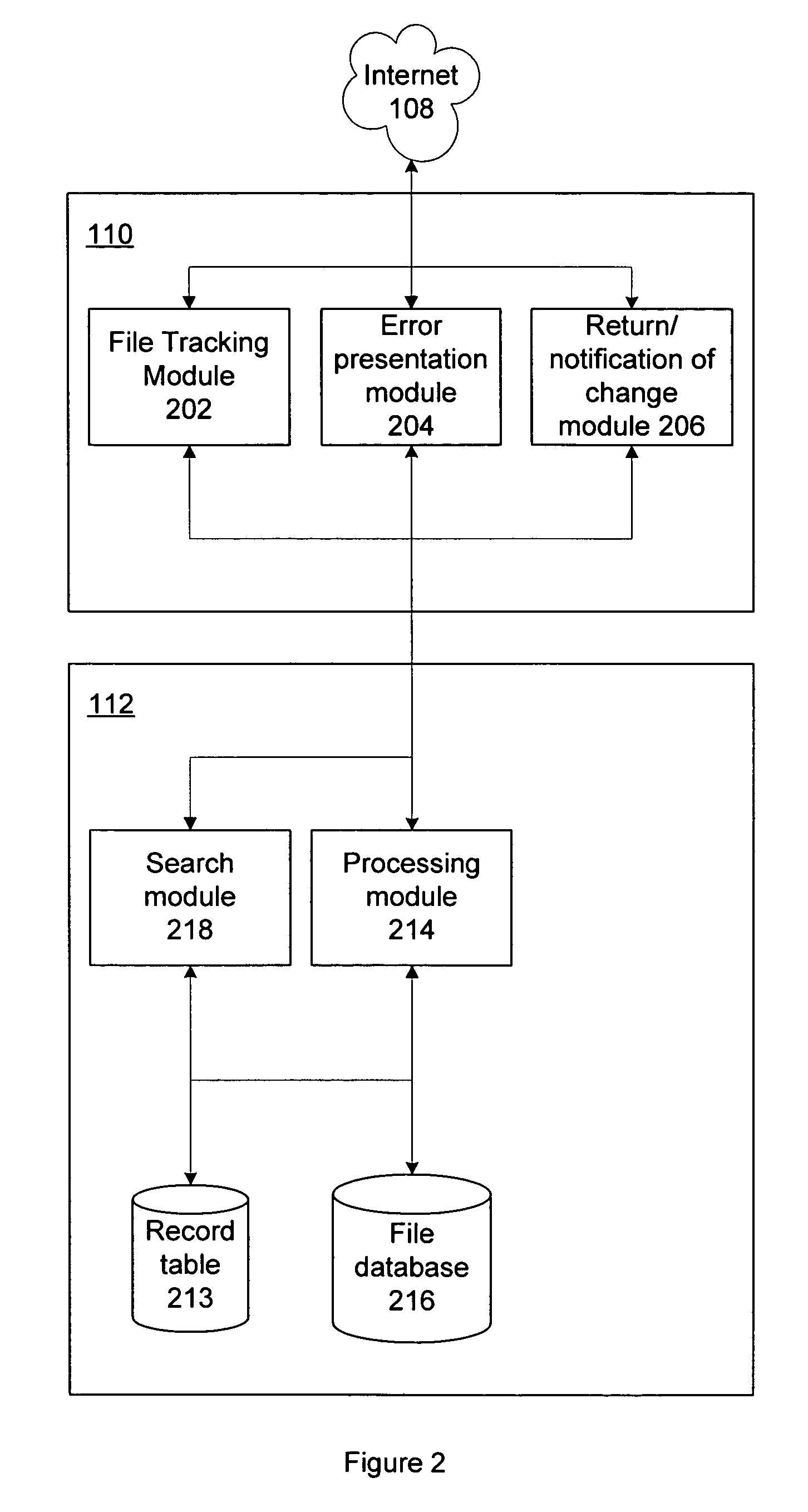

Method and system for tracking and reporting automated clearing house transaction status

Tracking and reporting status of automated clearing house (“ACH”) transactions. An ACH operator receives an ACH file comprising an ACH batch comprising an ACH transaction item for ACH processing. The operator tracks a status of the ACH file, batch, and item during multiple ACH processing events. A customer communicates a query for the status of the ACH file, batch, or item. The operator retrieves the tracked status of the ACH file, batch, or item and presents the tracked status to the customer. The ACH processing events typically comprise receiving the ACH file, confirming the ACH file, approving the ACH file, processing the ACH file, processing the ACH batch in the ACH file, and processing the ACH transaction item in the ACH batch. The operator can present a graphical depiction of errors the ACH file header, batch header, or item record detail.

Owner:US FEDERAL RESERVE BANK OF MINNEAPOLIS

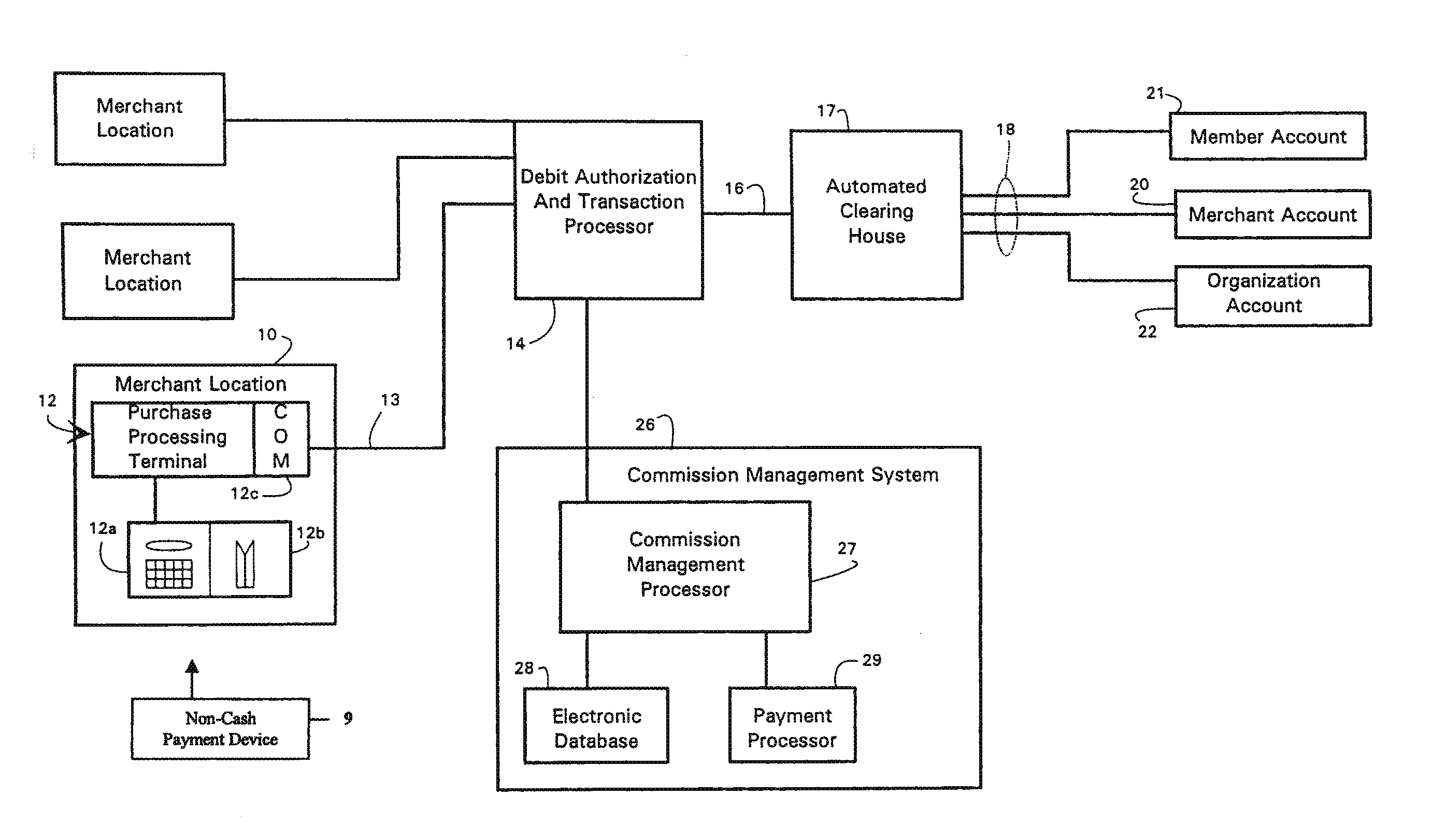

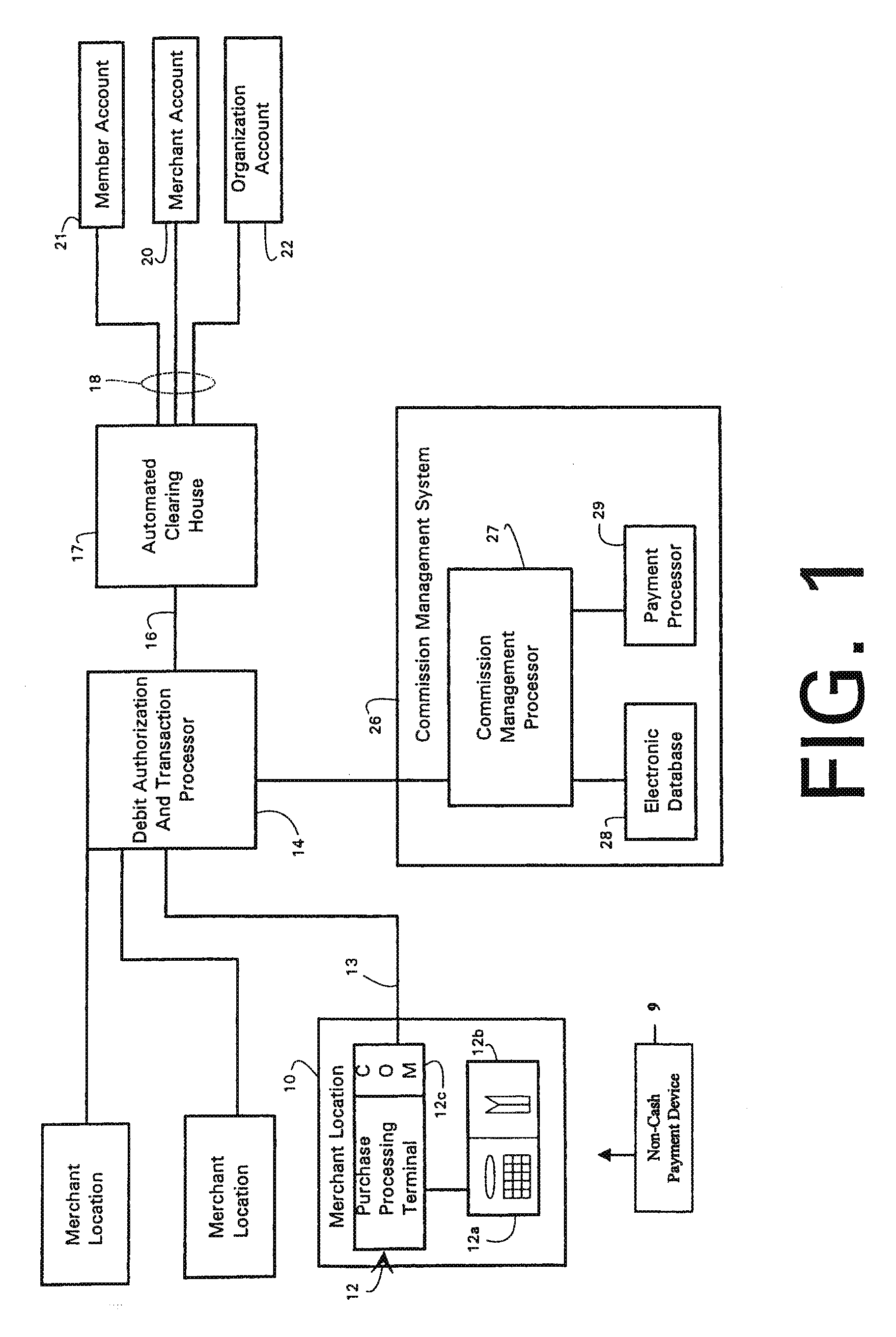

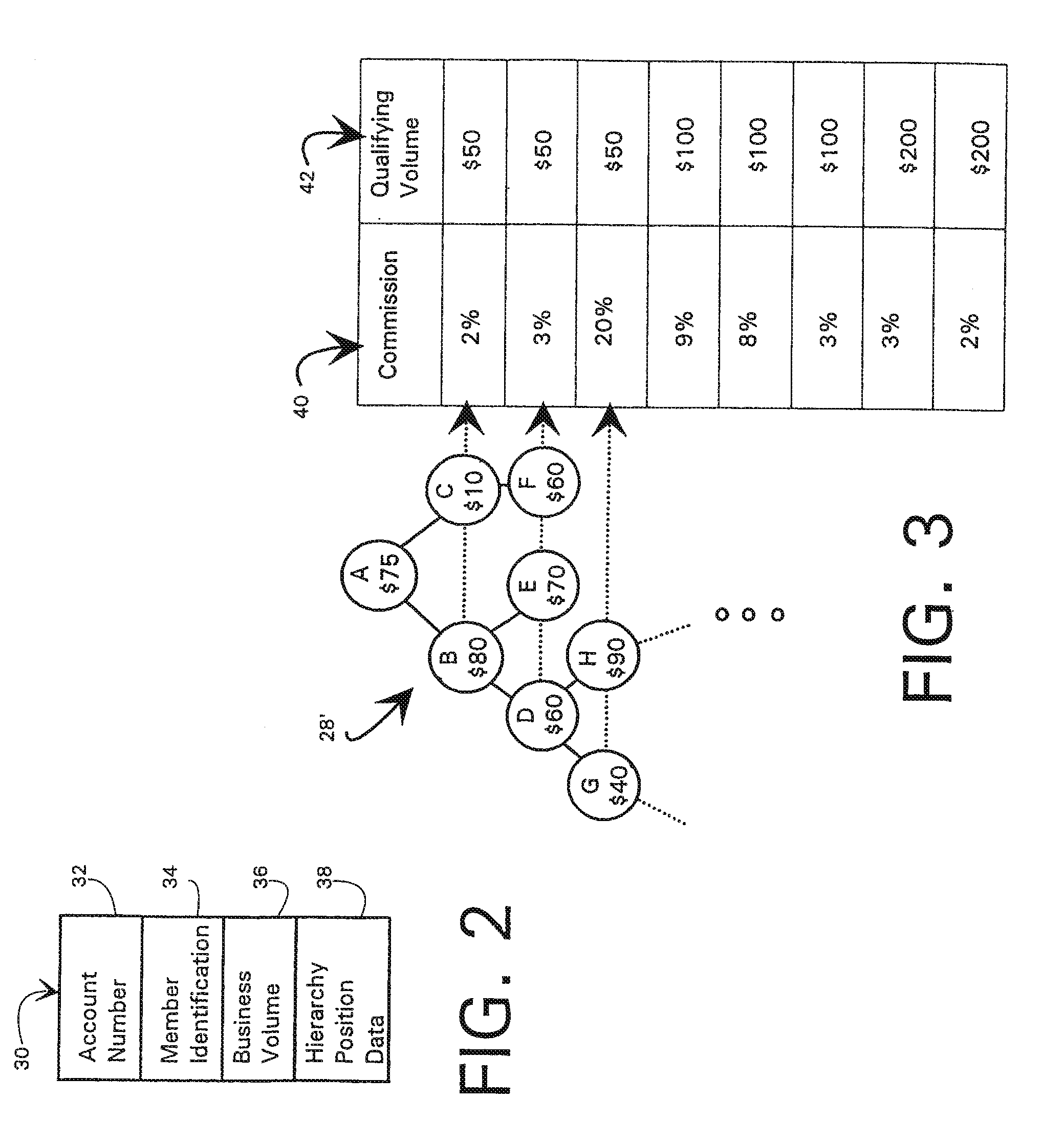

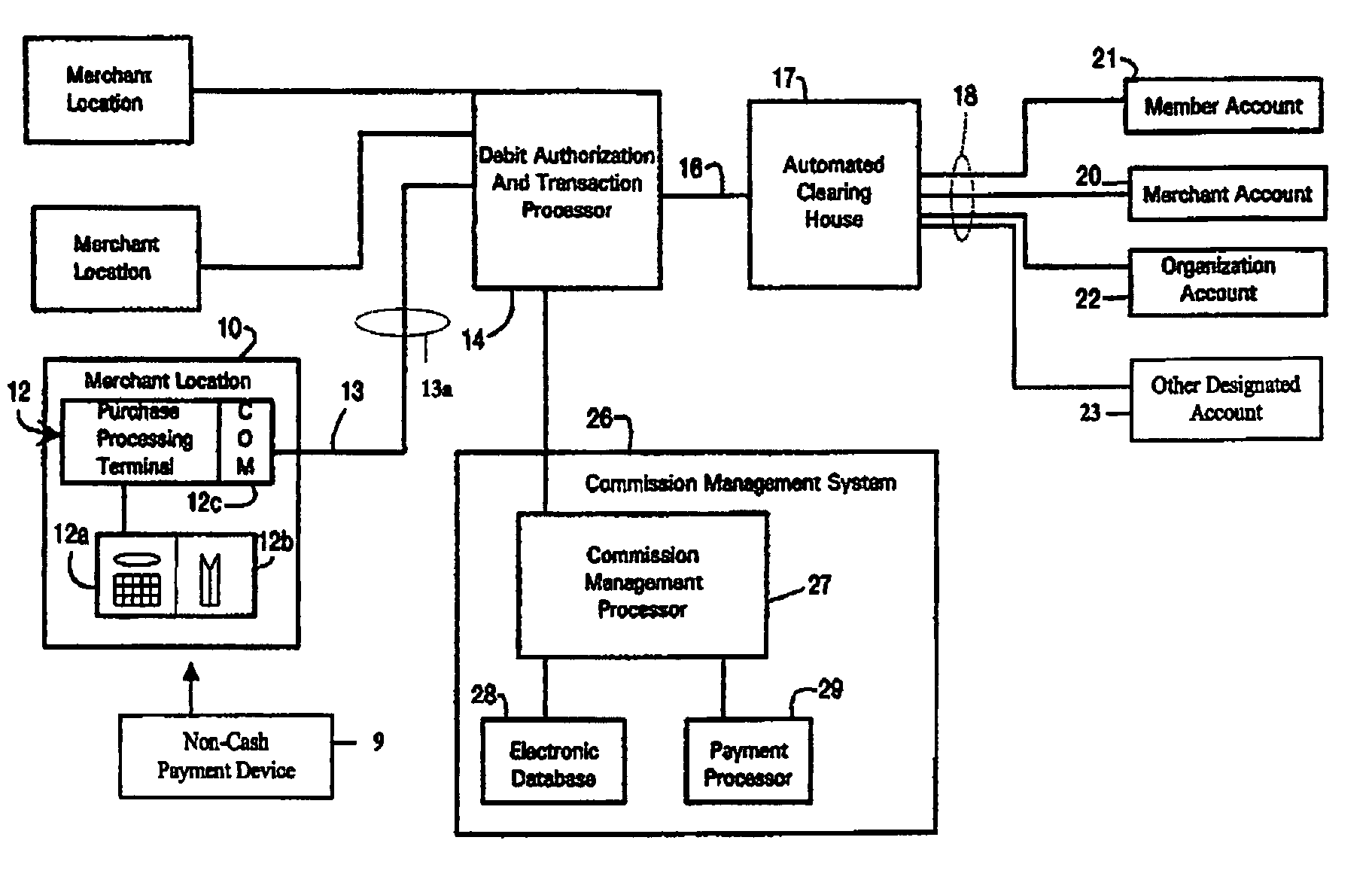

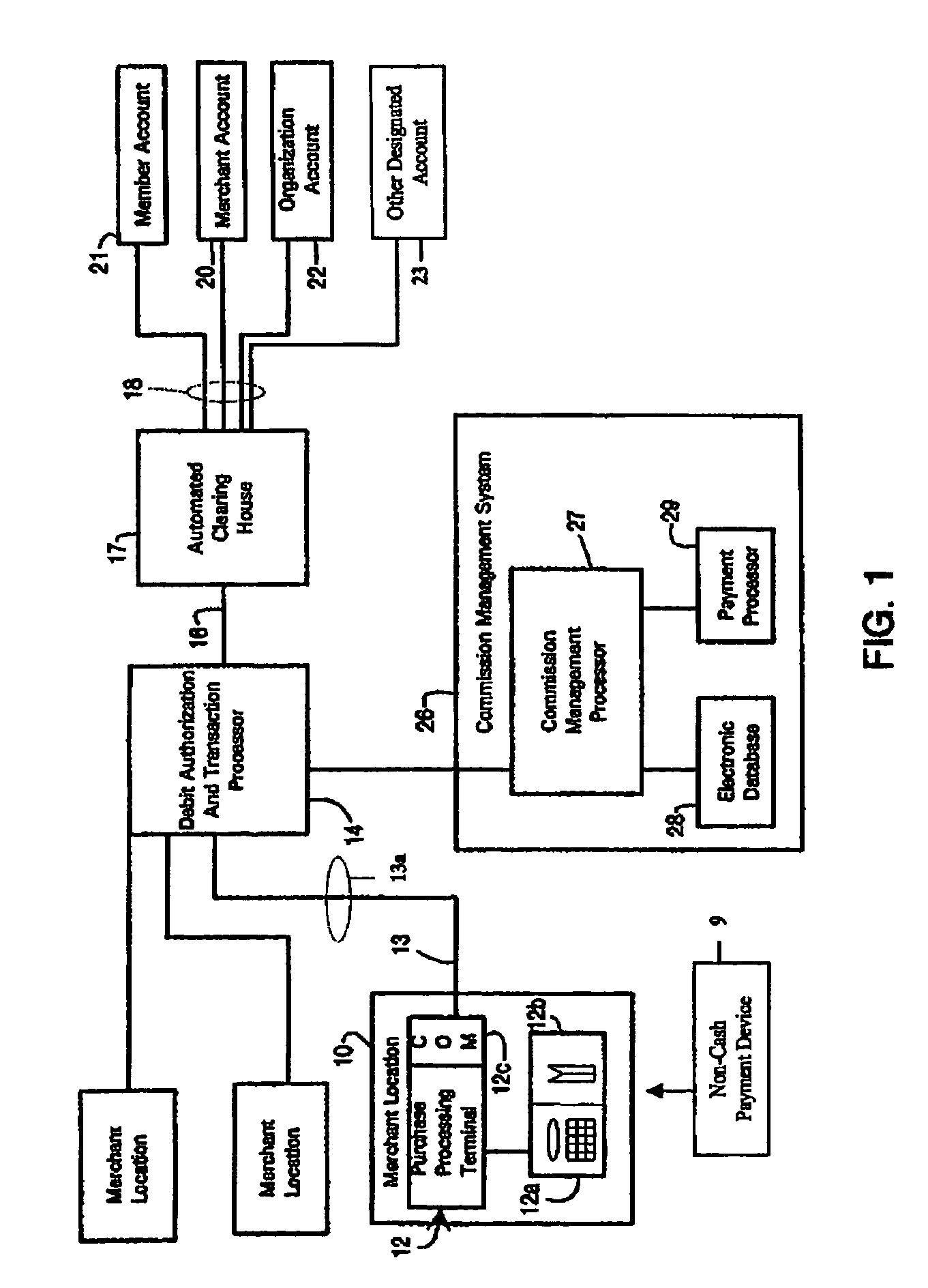

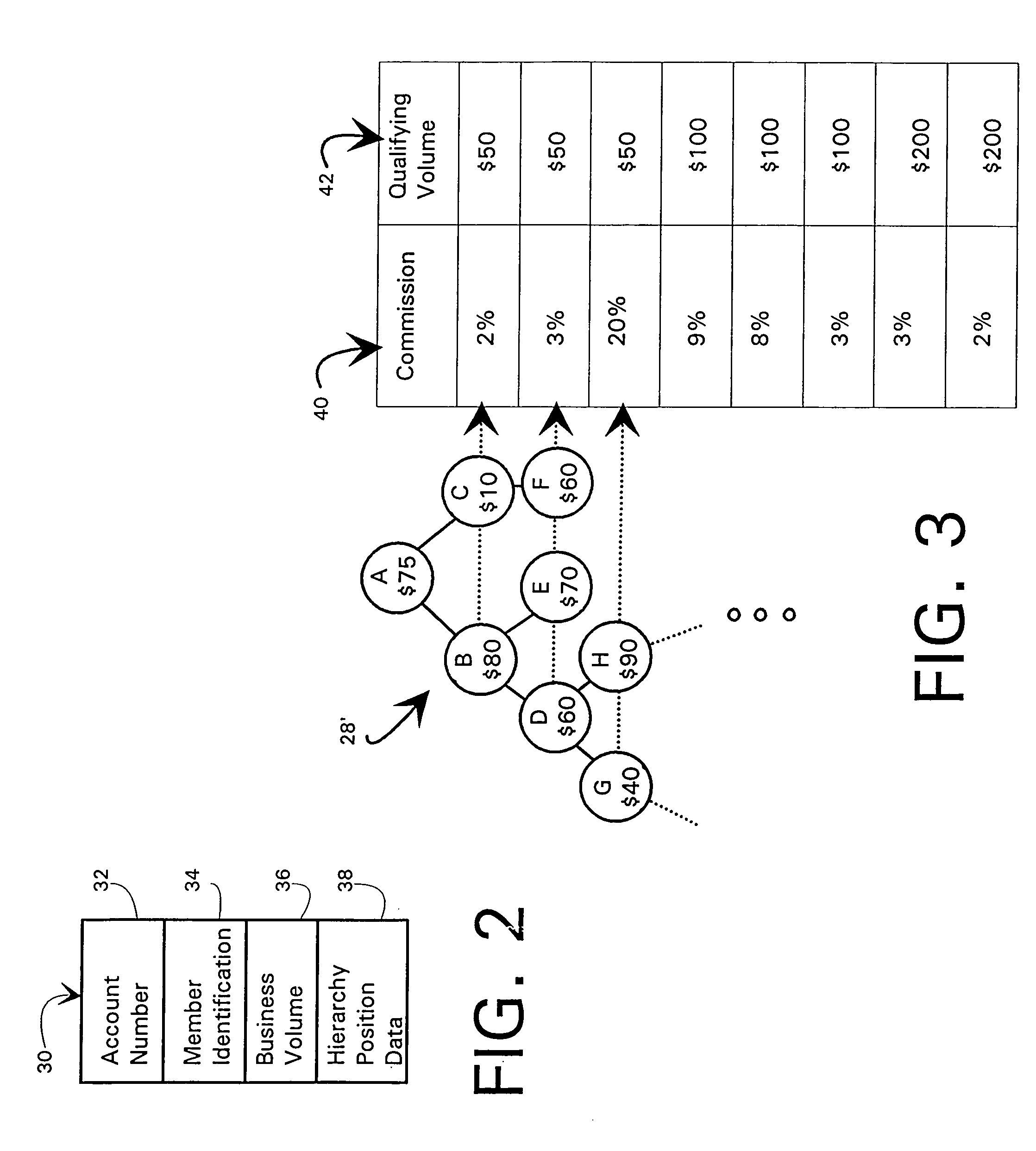

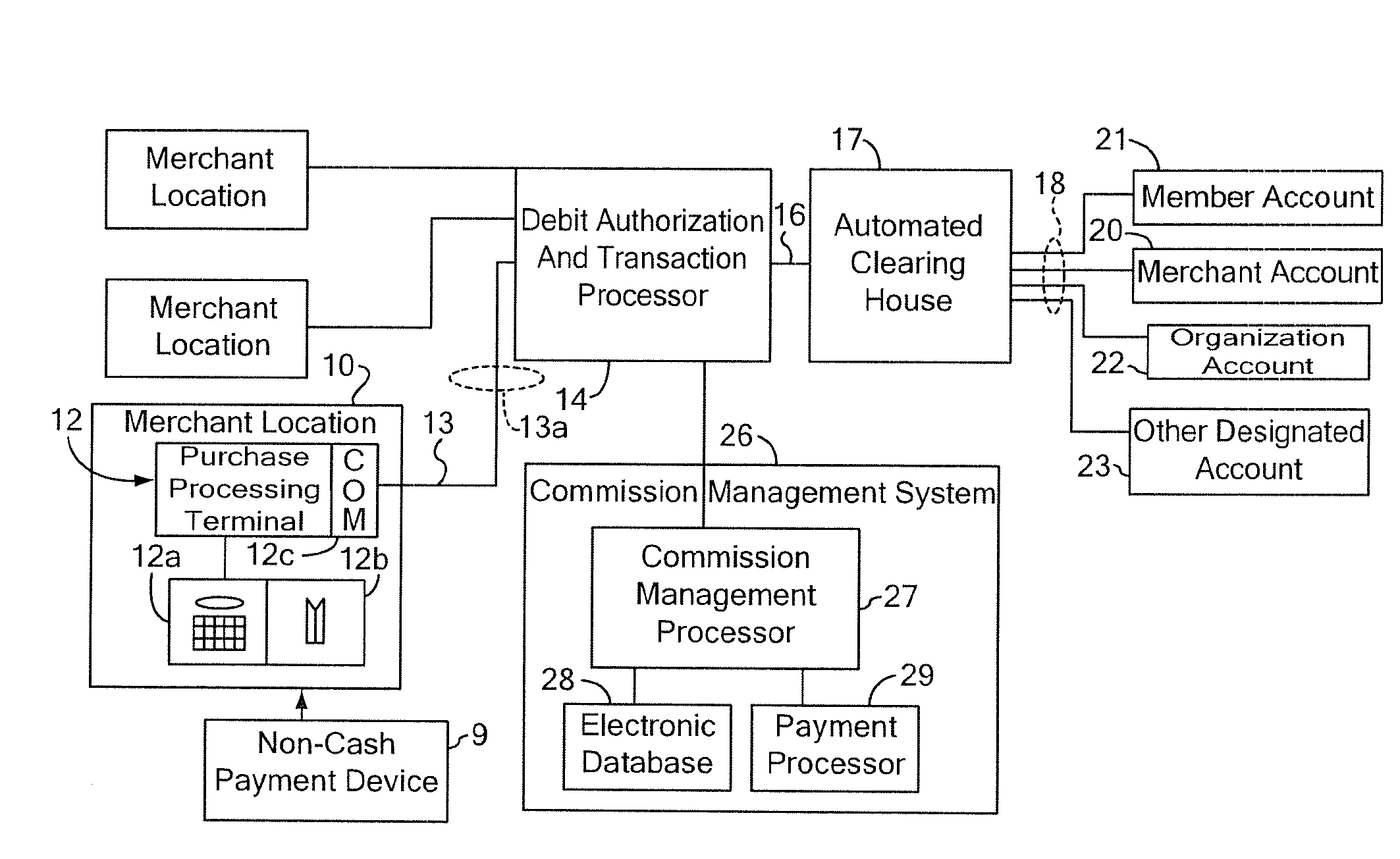

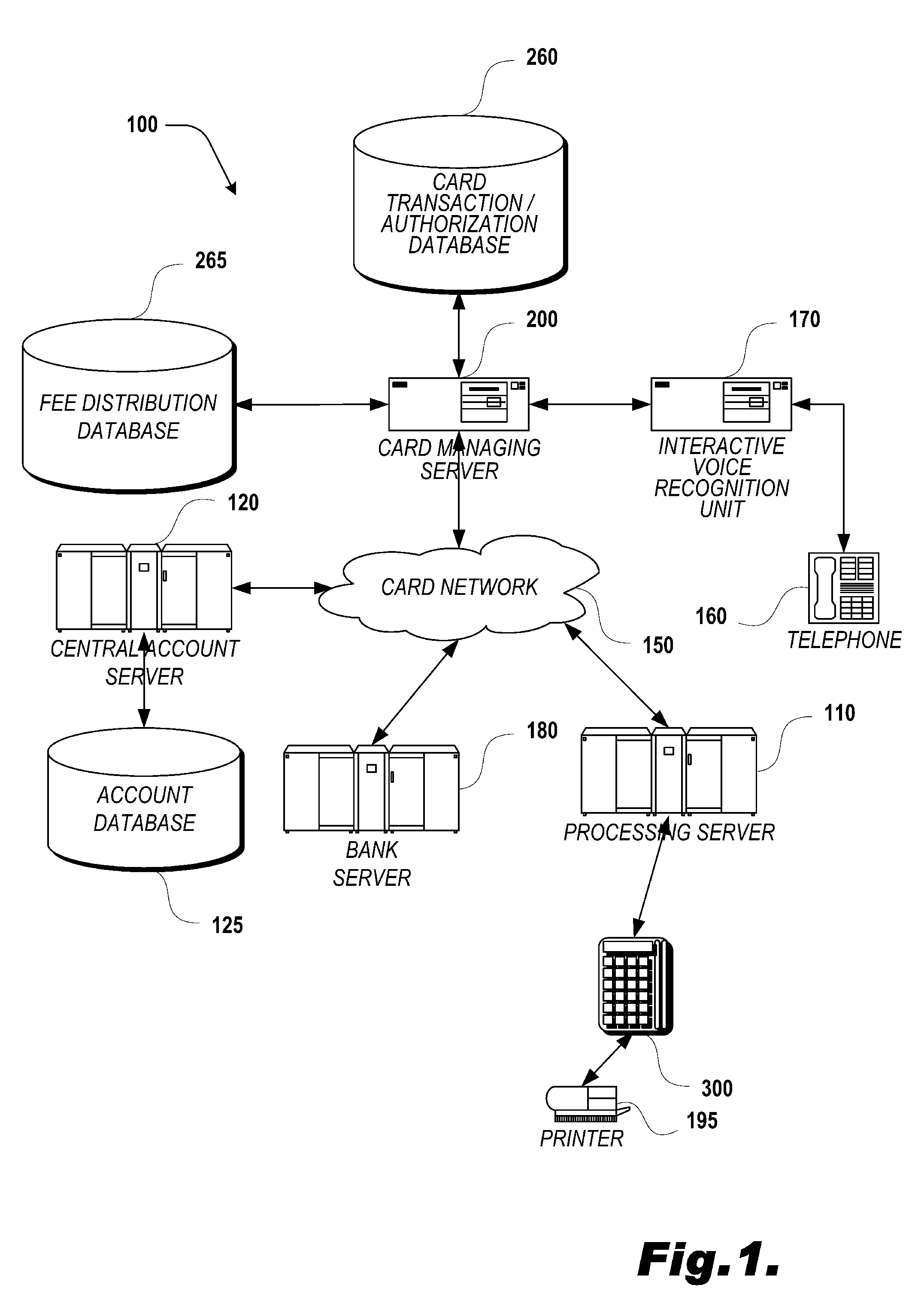

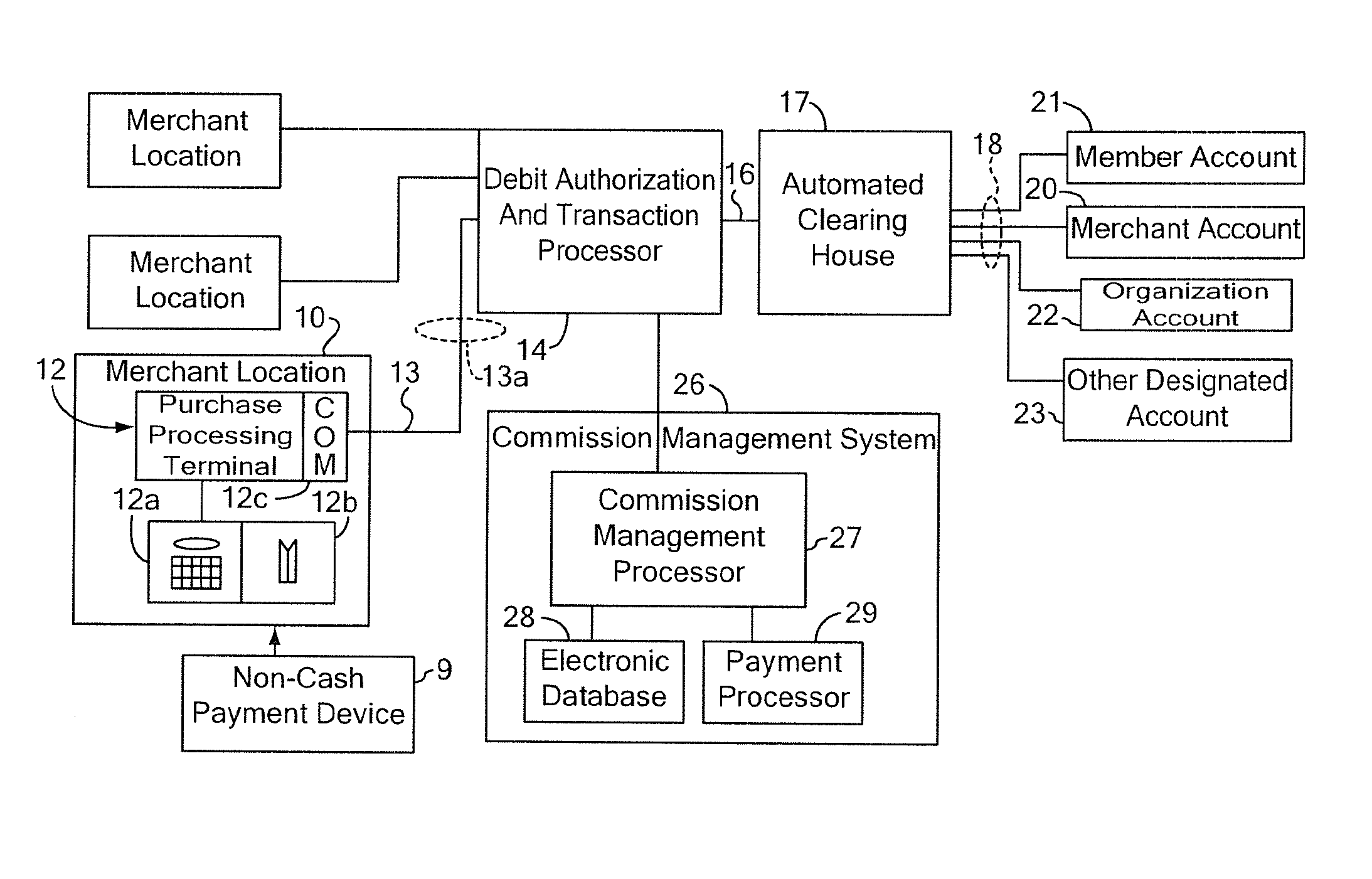

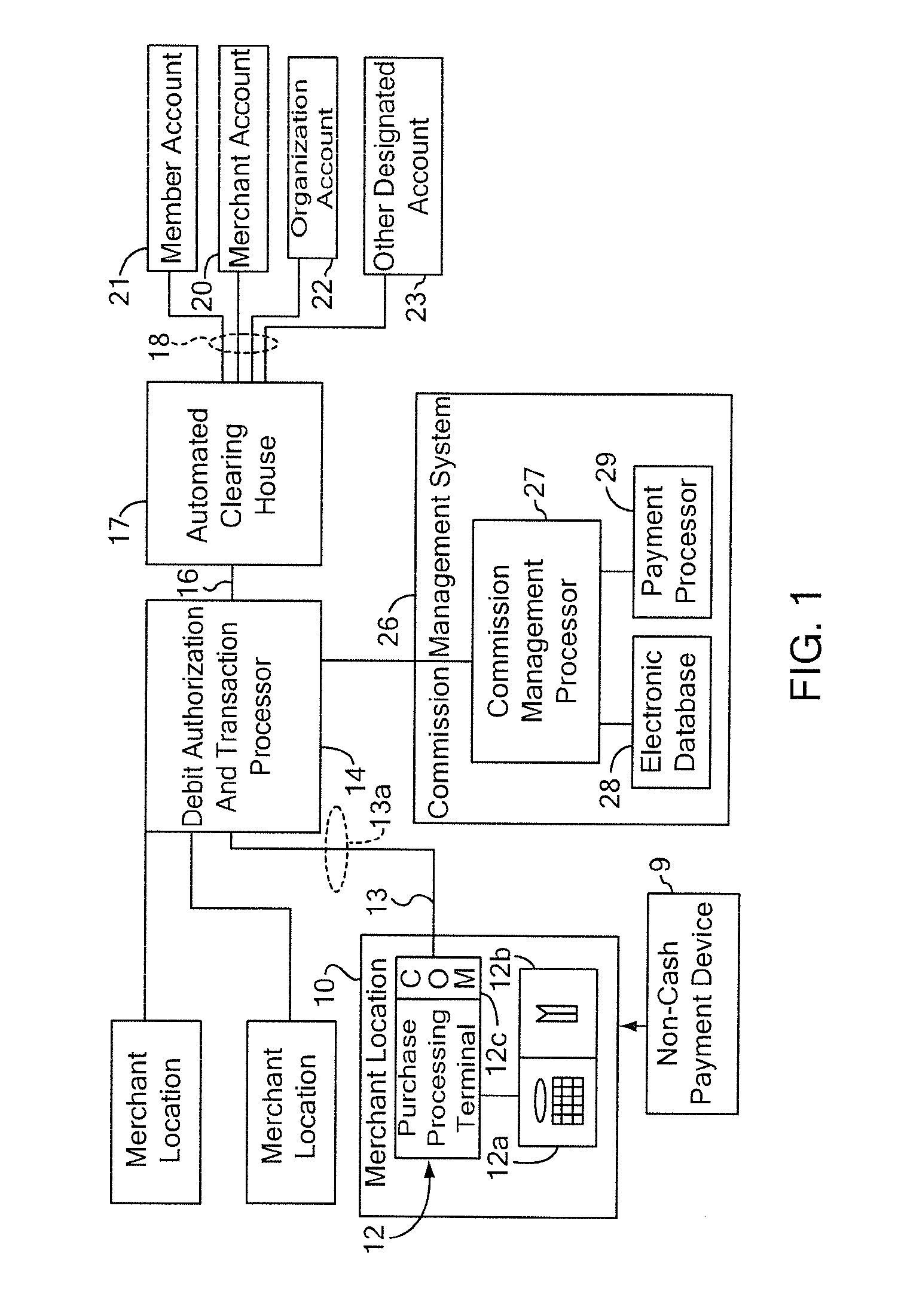

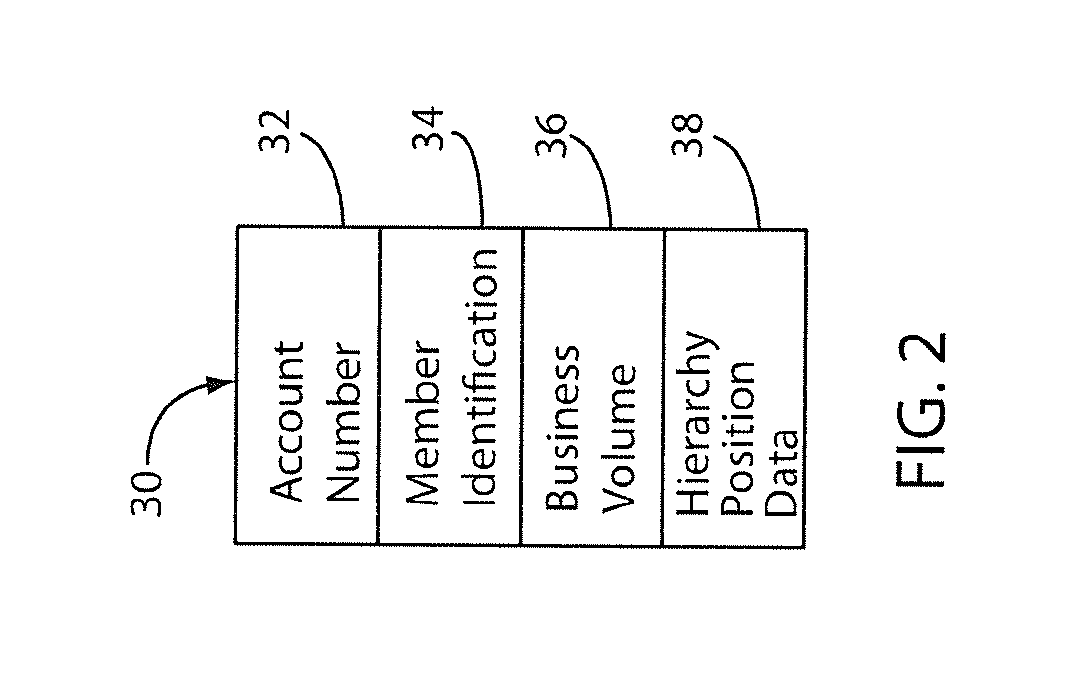

Non-cash transaction incentive and commission distribution system

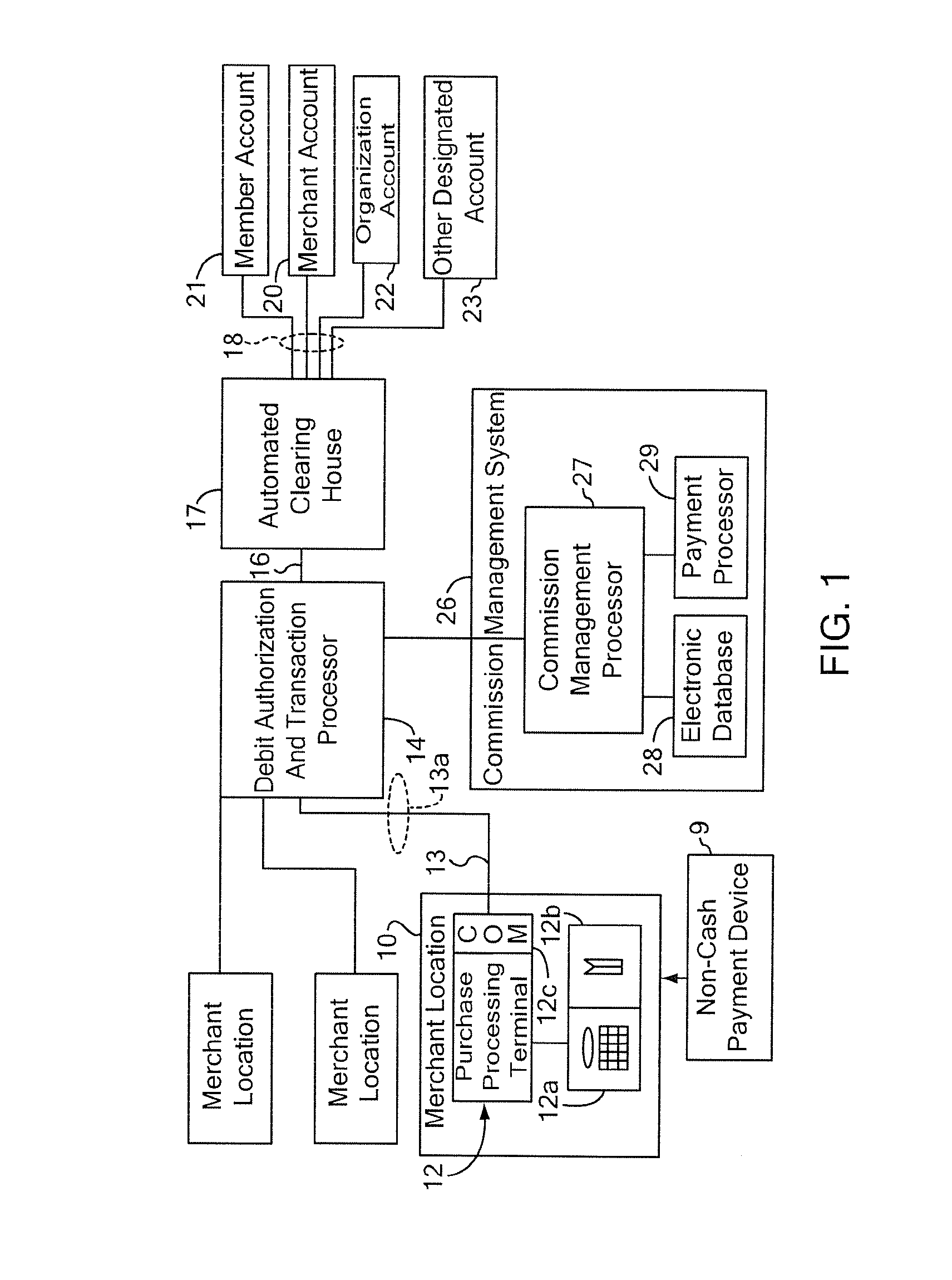

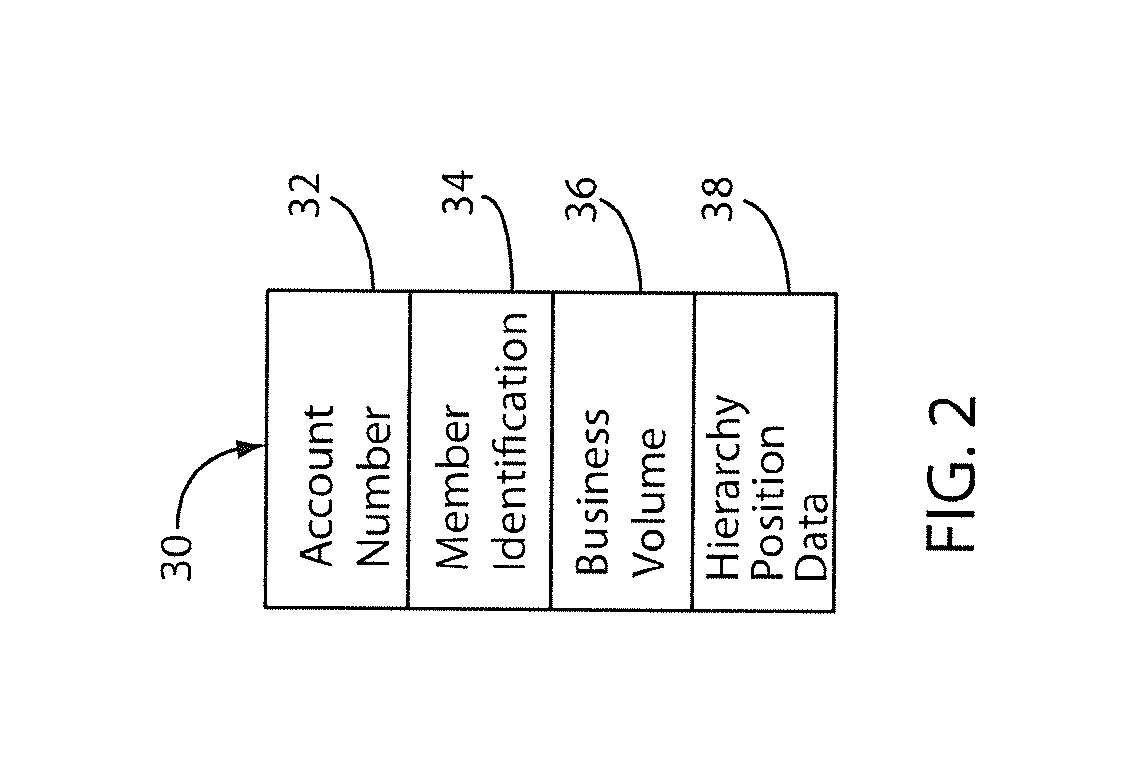

InactiveUS20090216640A1Complete banking machinesDiscounts/incentivesNetwork structureDistribution system

An electronic fund transfer system is disclosed wherein commissions for point-of-sale purchase transactions are determined and distributed to members of an organizational network for promoting use of a non-cash payment device that is tangible for effecting purchase transactions. Purchase data is electronically transmitted from the point-of-sale to an automated clearing house for effecting fund transfers to prepare the purchase, and also to a commission management system. The commission management system maintains an electronic database reflecting the structure of the organizational network, and further determines the distribution of purchase commissions according to a predetermined schedule of proportions relating to the position and business volume of each member of the network. The commission management system further comprises a payment processor for effecting commission payments to the members or to a designated sponsor on a scheduled basis.

Owner:MASI LARRY A

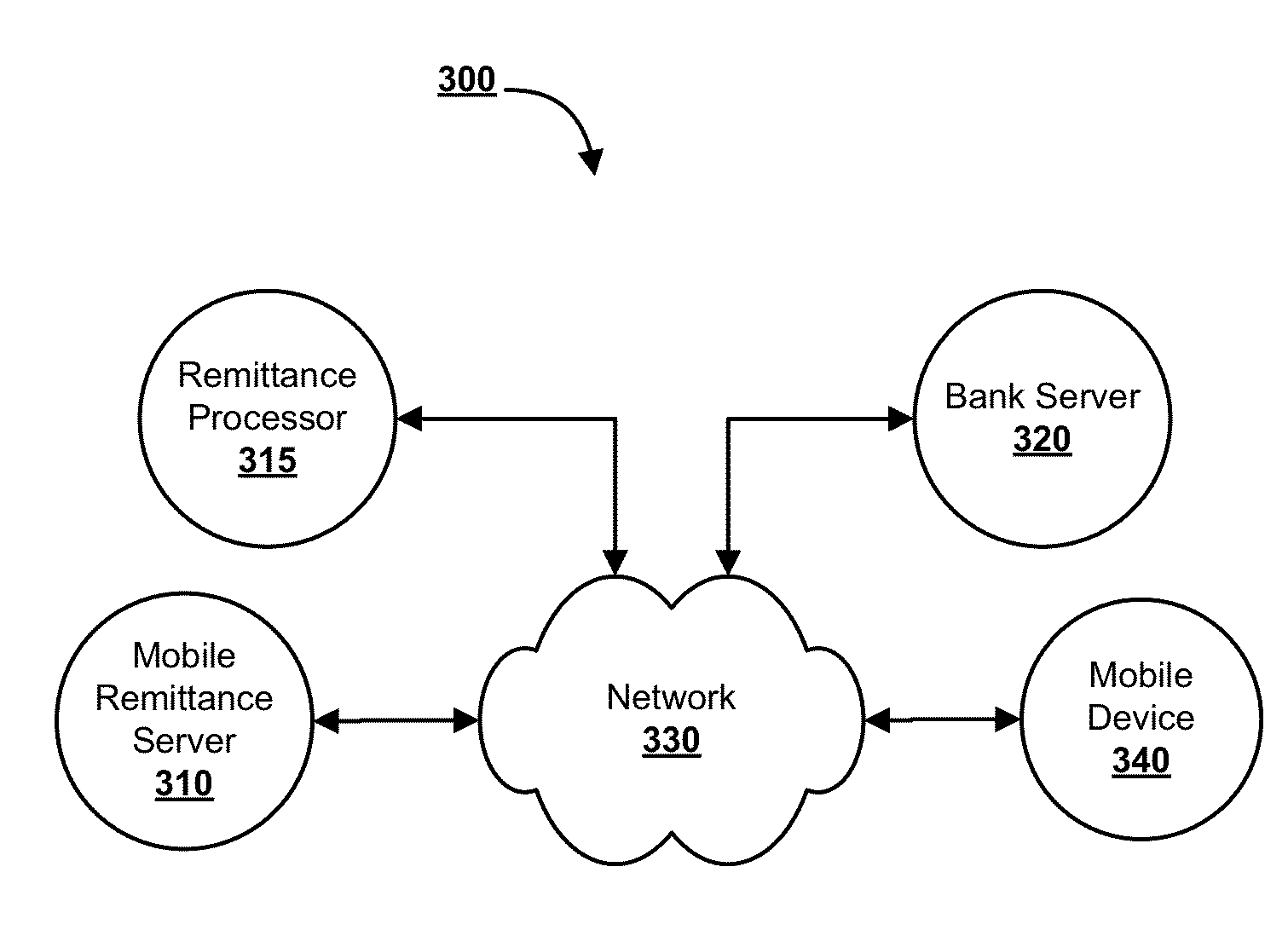

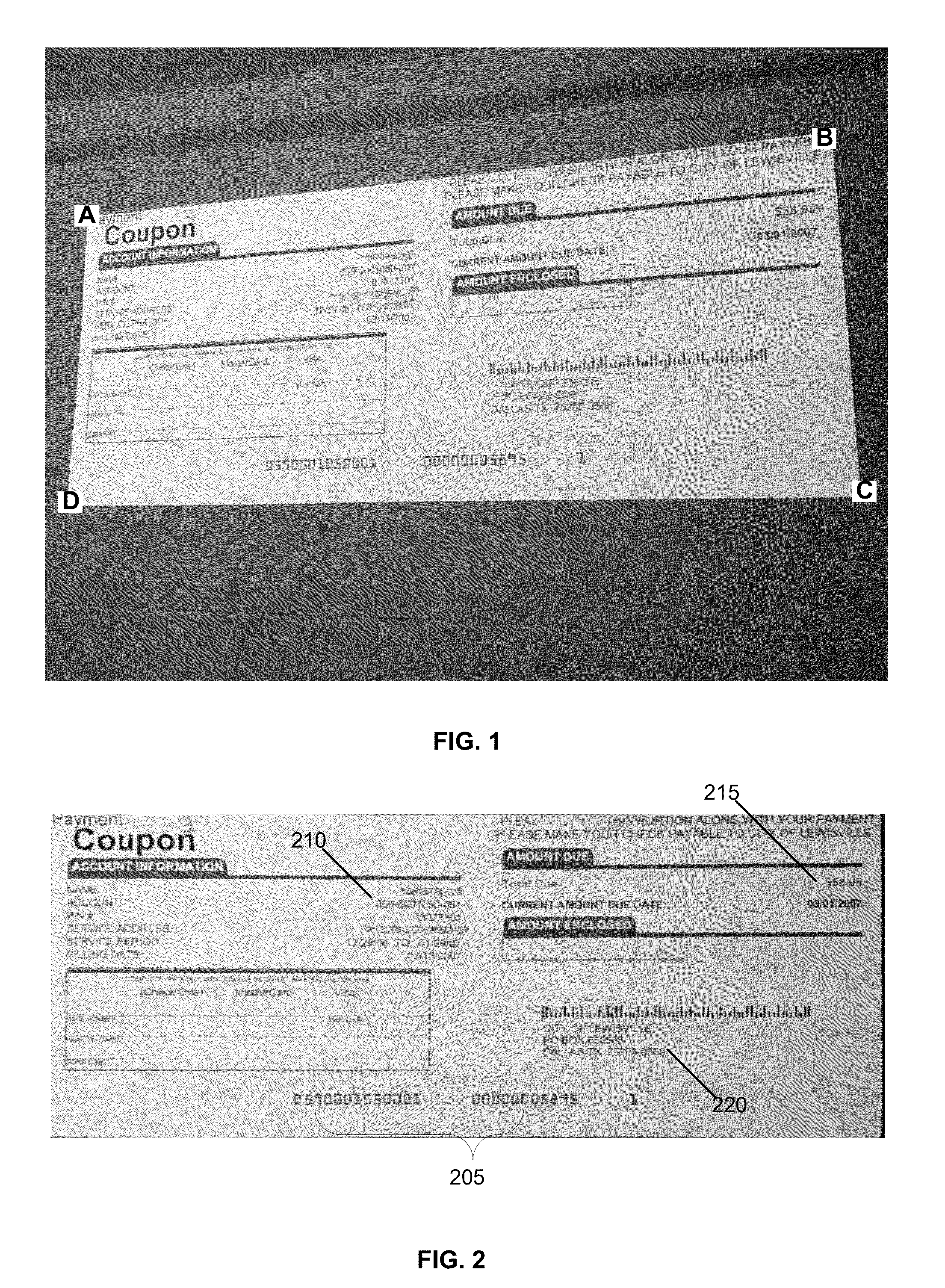

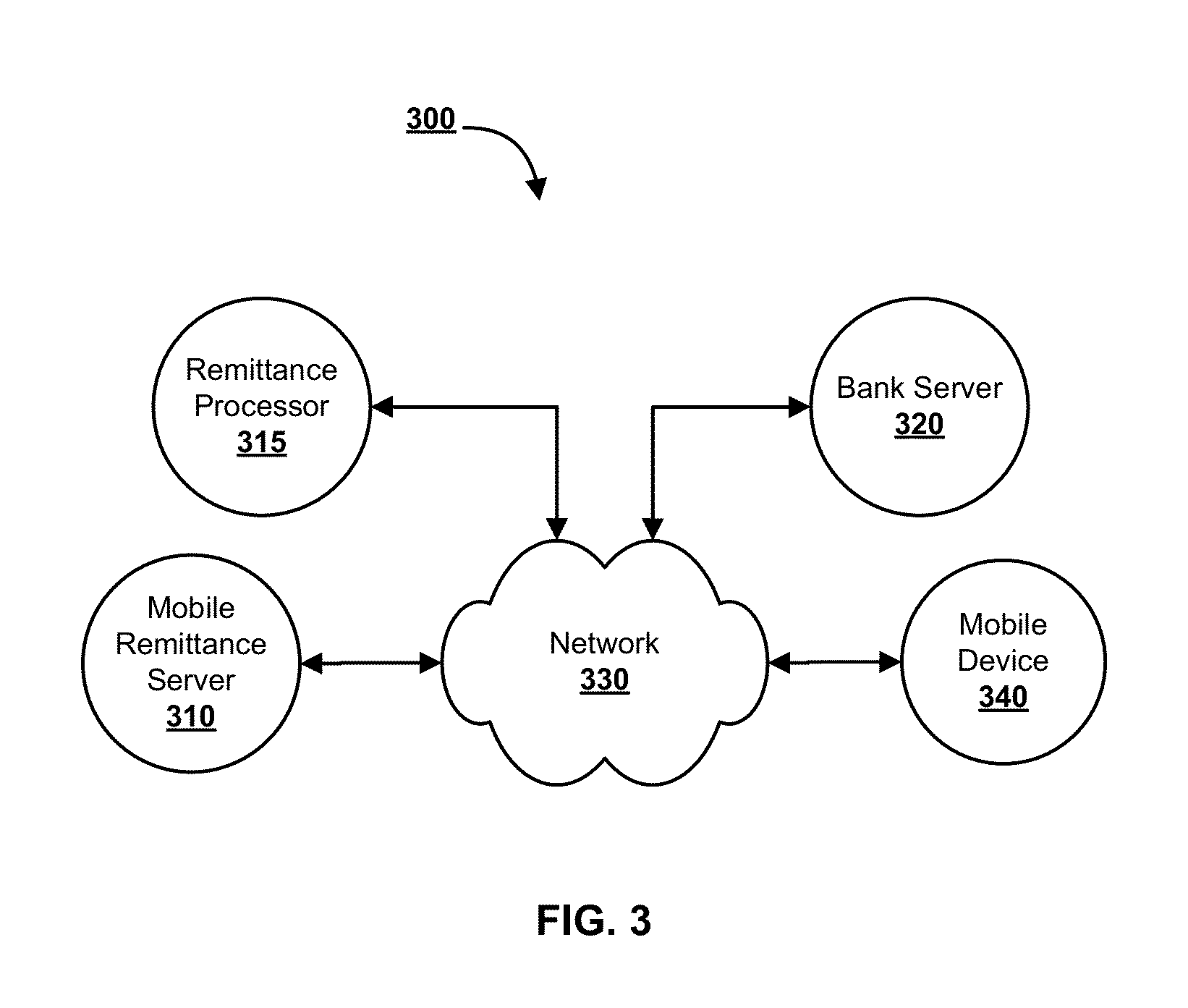

Systems and methods for mobile automated clearing house enrollment

Systems and methods for mobile enrollment in automated clearing house (ACH) transactions using mobile-captured images of financial documents are provided. Applications running on a mobile device provide for the capture and processing of images of documents needed for enrollment in an ACH transaction, such as a blank check, remittance statement and driver's license. Data from the mobile-captured images that is needed for enrolling in ACH transactions is extracted from the processed images, such as a user's name, address, bank account number and bank routing number. The user can edit the extracted data, select the type of document that is being captured, authorize the creation of an ACH transaction and select an originator of the ACH transaction. The extracted data and originator information is transmitted to a remote server along with the user's authorization so the ACH transaction can be setup between the originator's and receiver's bank accounts.

Owner:MITEK SYST

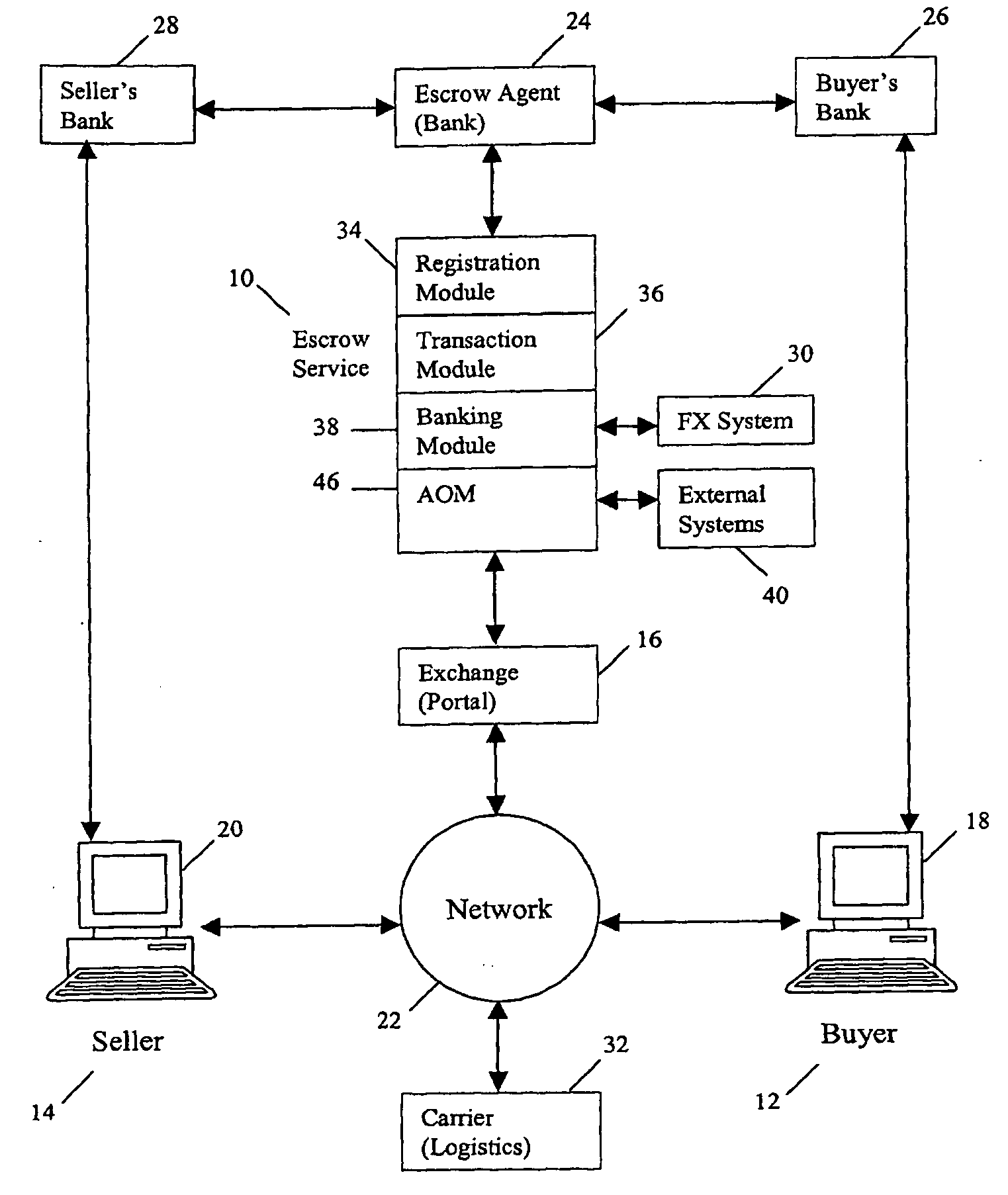

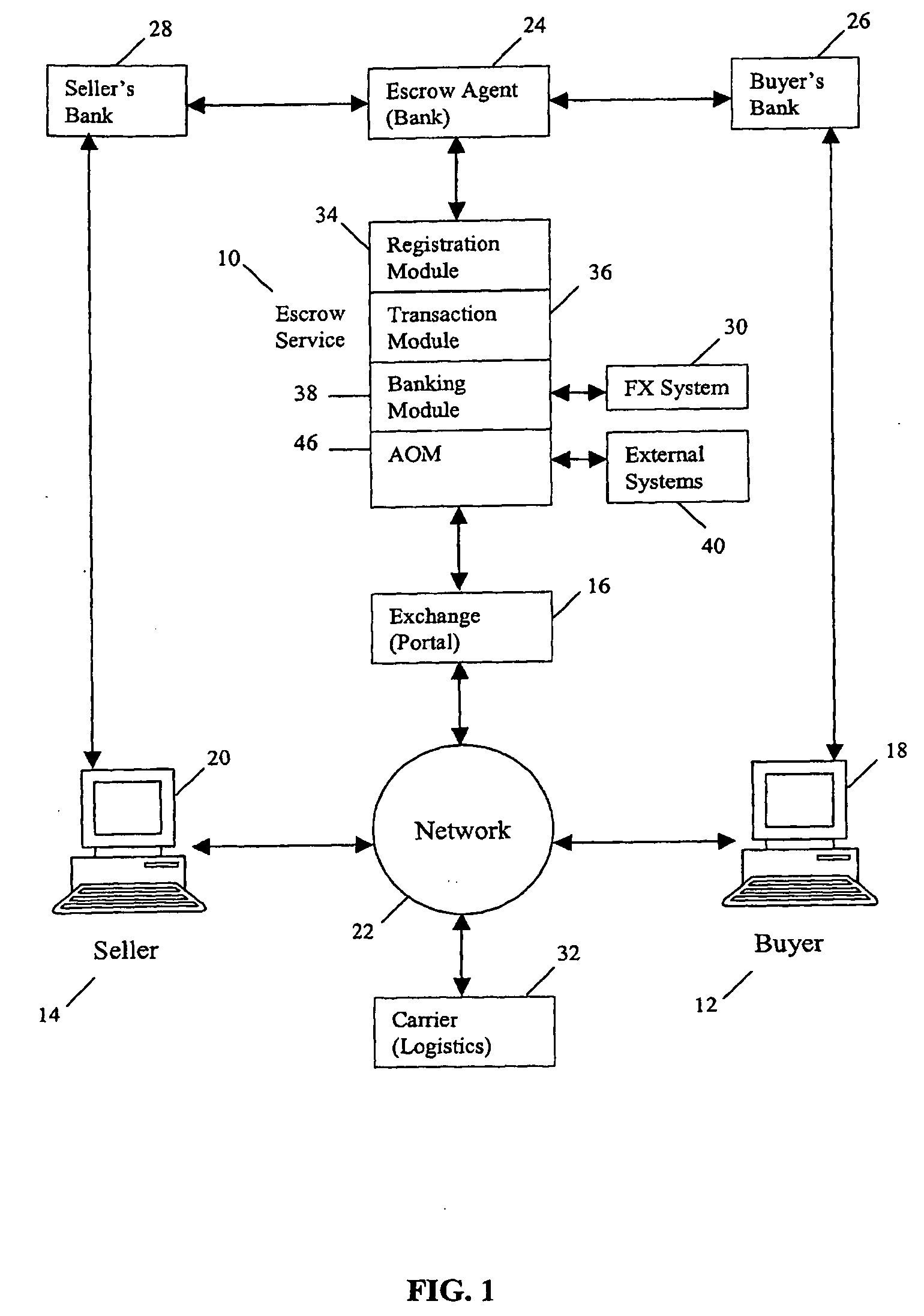

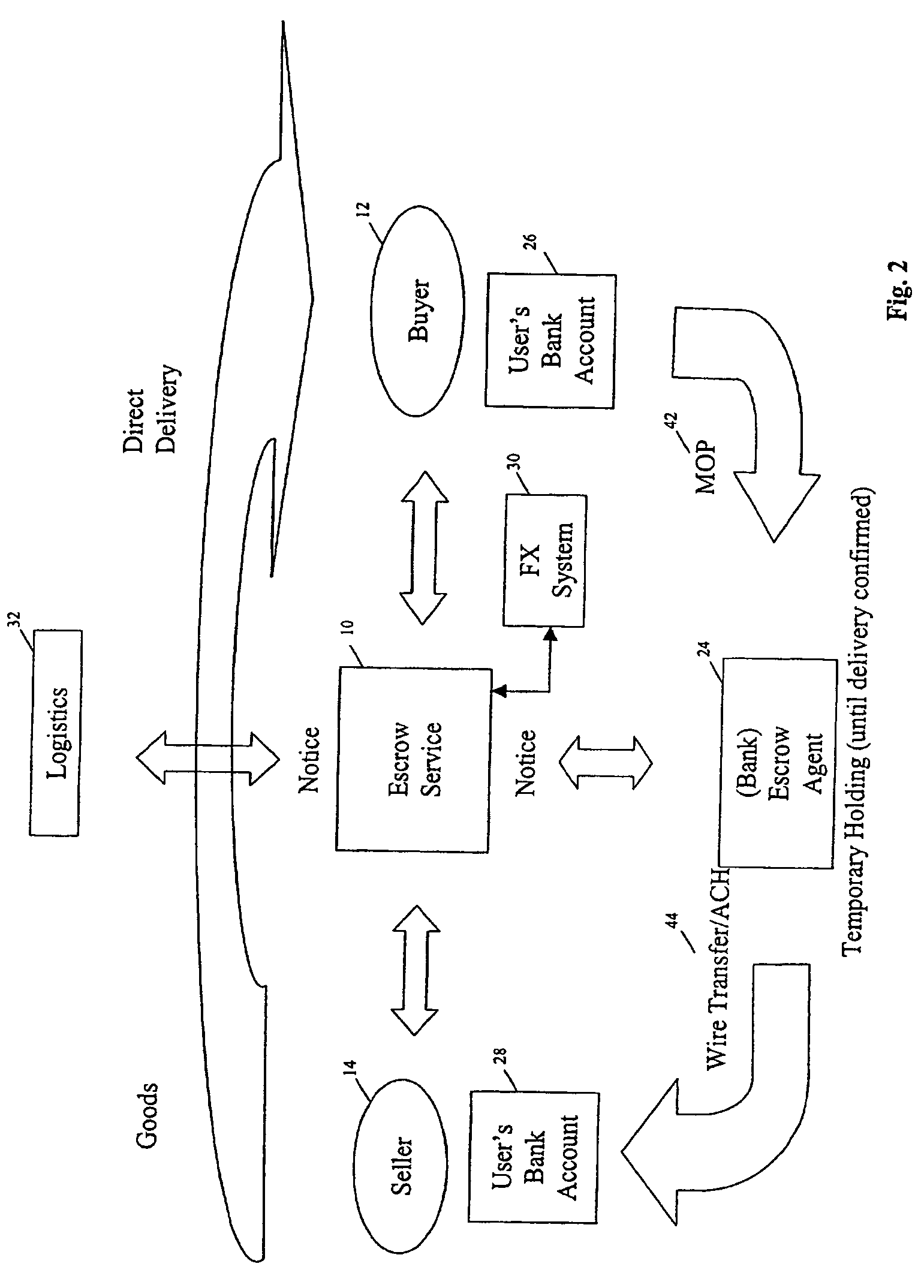

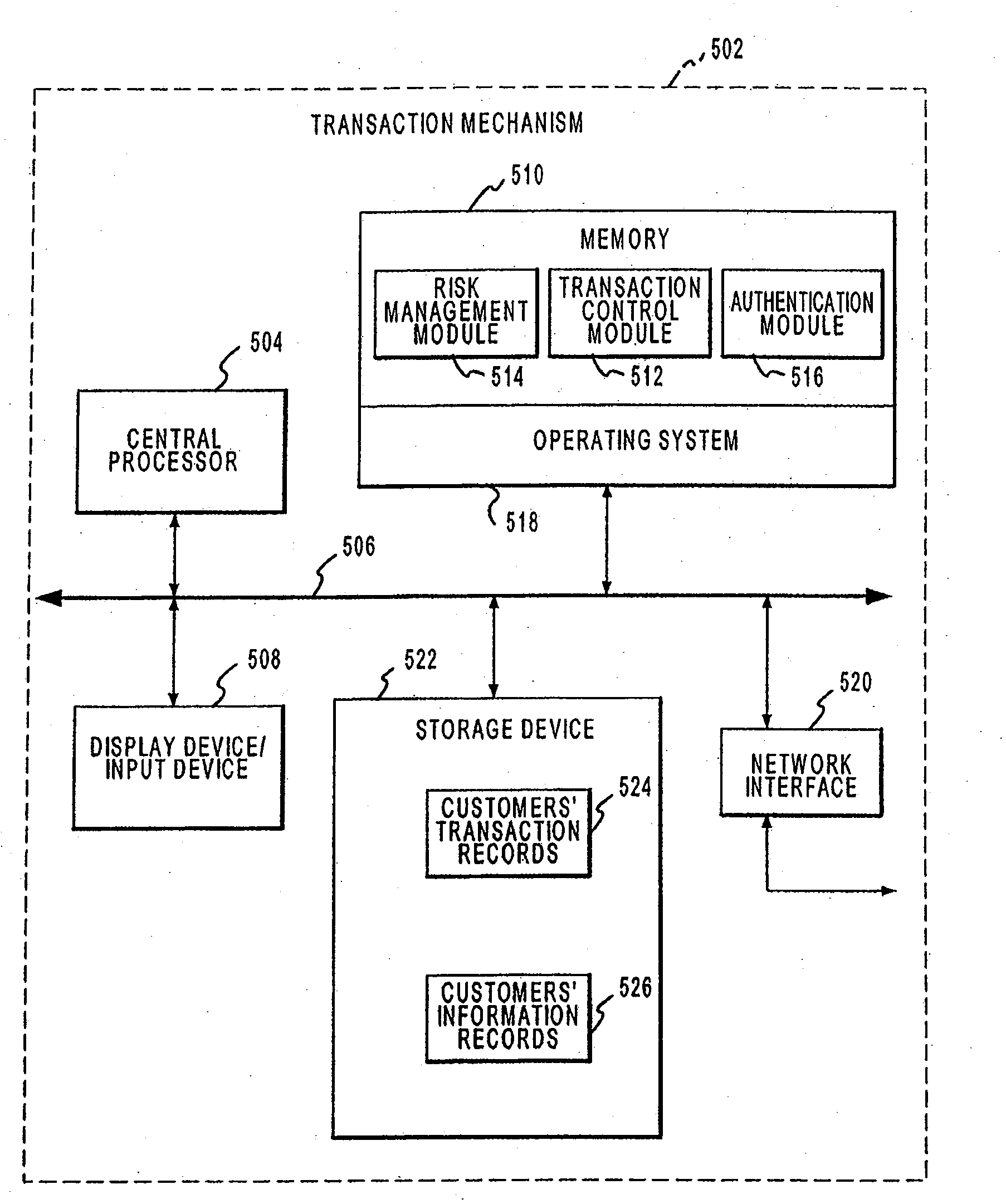

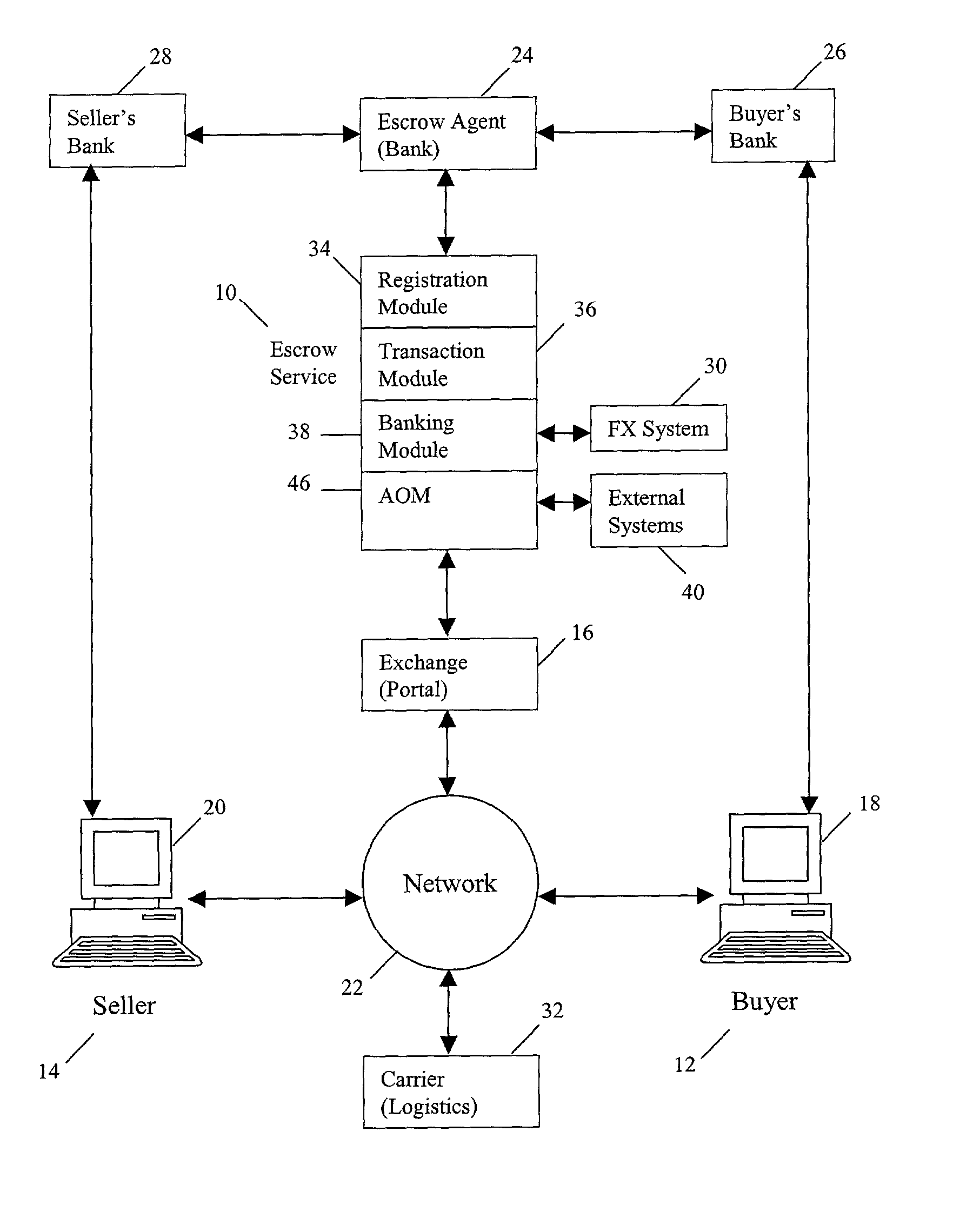

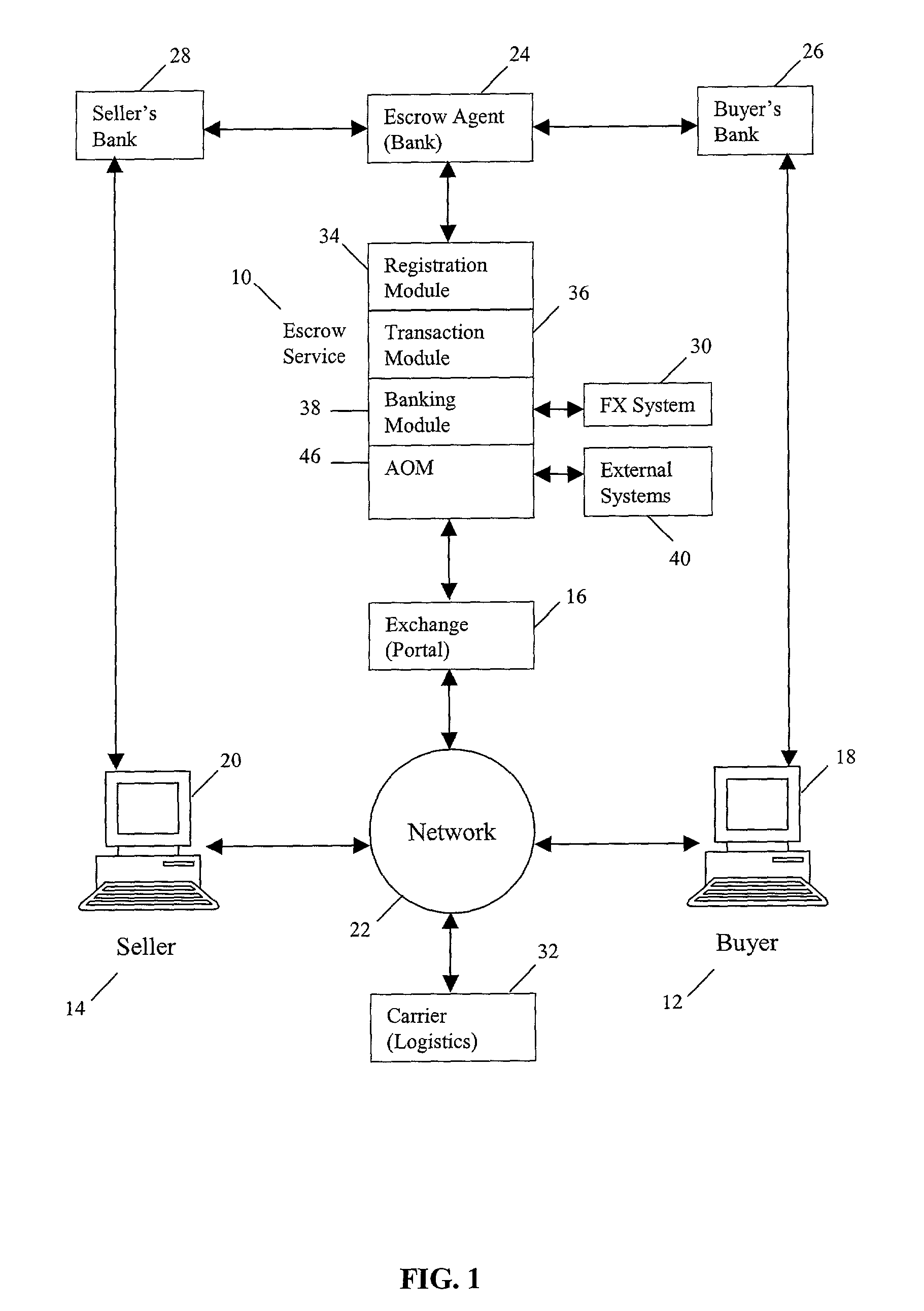

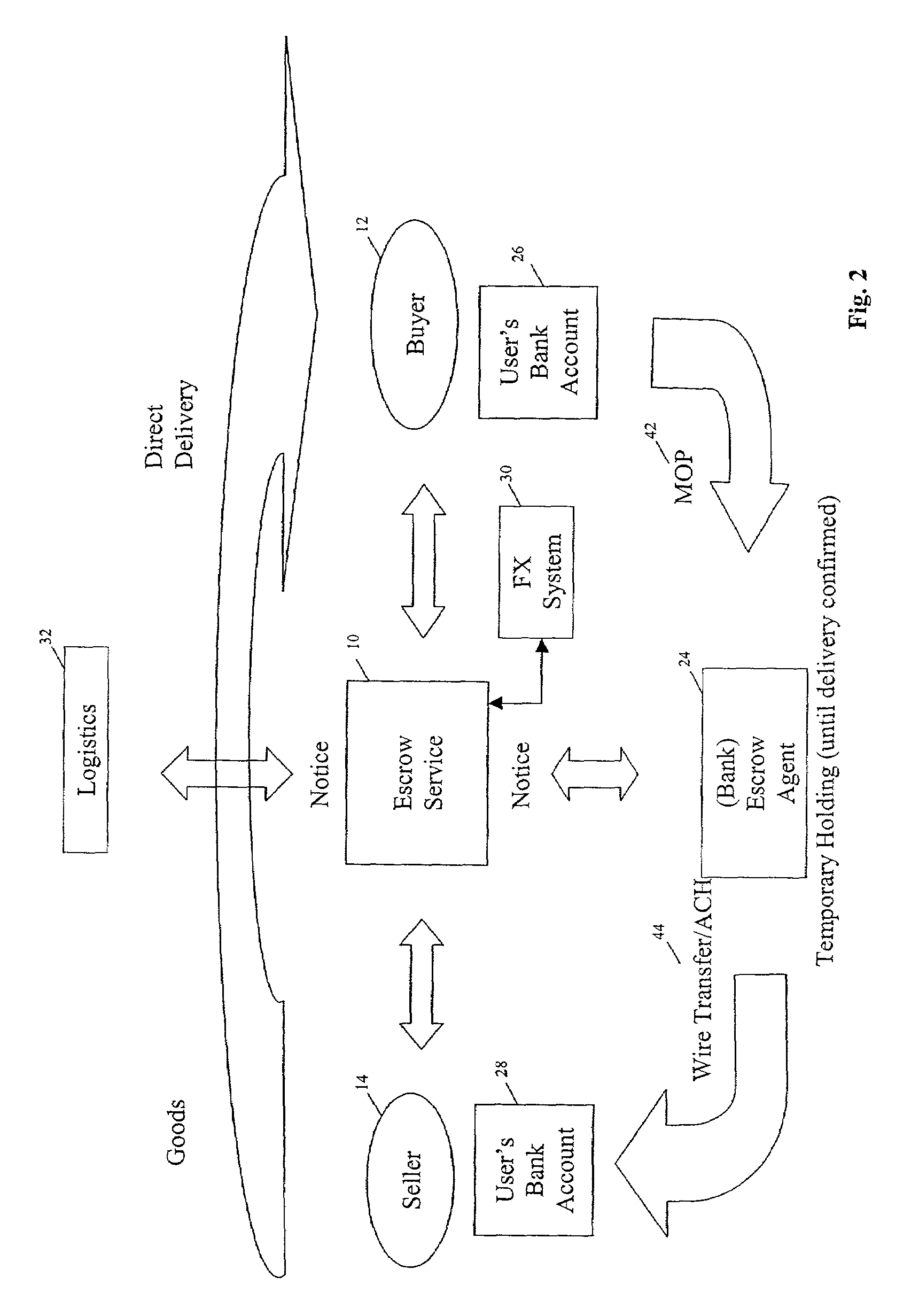

Method and system for multi-currency escrow service for web-based transactions

A method and system for escrow service for web-based transactions, such as multi-currency web-based transactions, is web-accessible and accepts registrations from exchanges and / or portal partners. The completion of registration and transactions is allowed to entitled users who access the system via the web. The system maintains an internal banking engine to act as a deal manager, messaging service and accounts sub-ledger and escrows funds entrusted to it. The transaction process is composed of a number of transaction statuses, and reporting of those statuses to users is accomplished online and via web query. The system provides local currency / multi-currency capability and supports several methods of payment, such as credit cards, authorized Automated Clearing House (ACH) or equivalent direct debit / credit and wire transfer payments, and all funds movements are electronic. The system supports transaction level detail through its banking engine accounts; funds movements from its currency accounts, and escrows funds to currency based escrow accounts. Buyers completing goods / services inspections after delivery initiate settlements.

Owner:CITIBANK

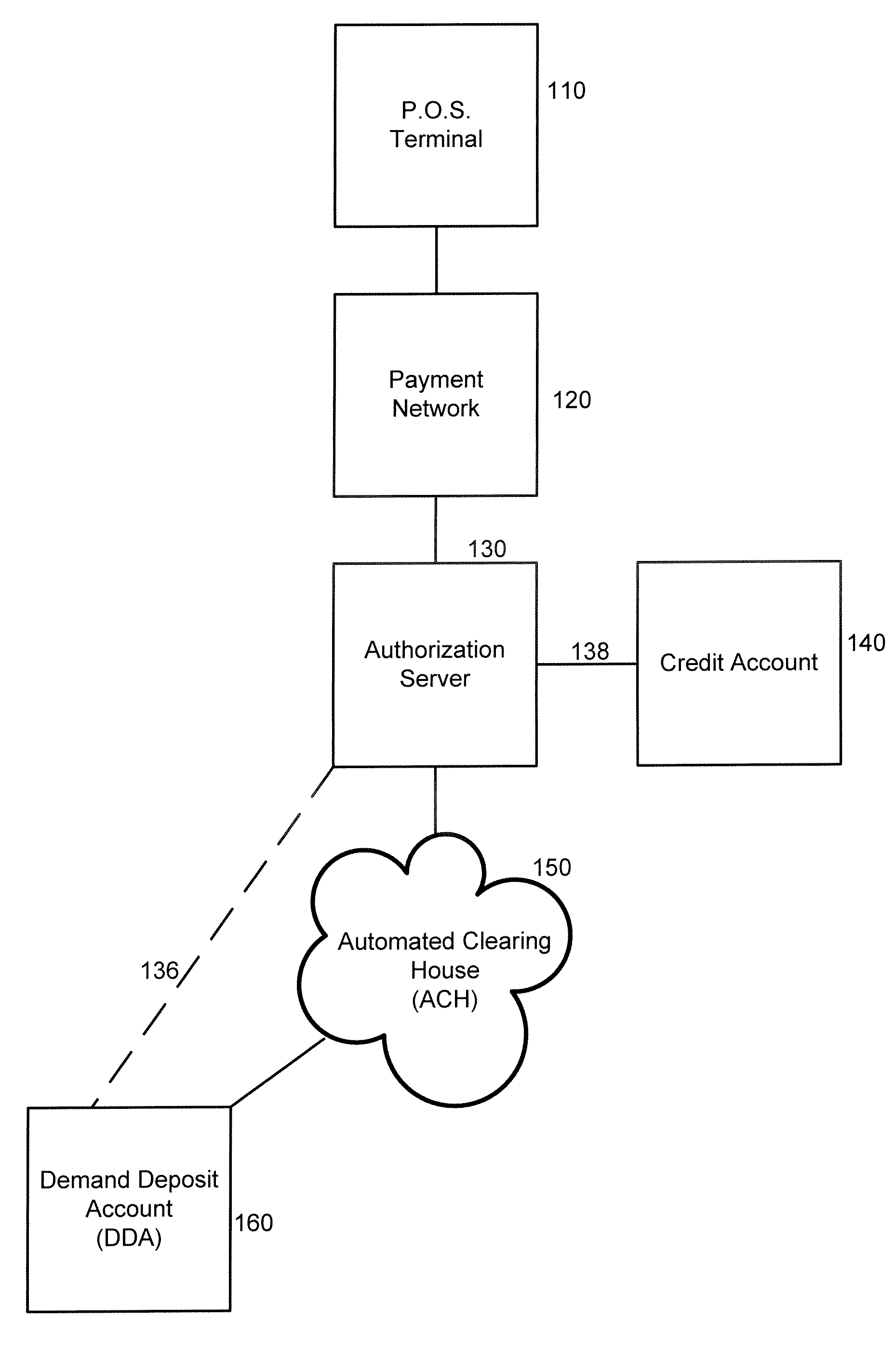

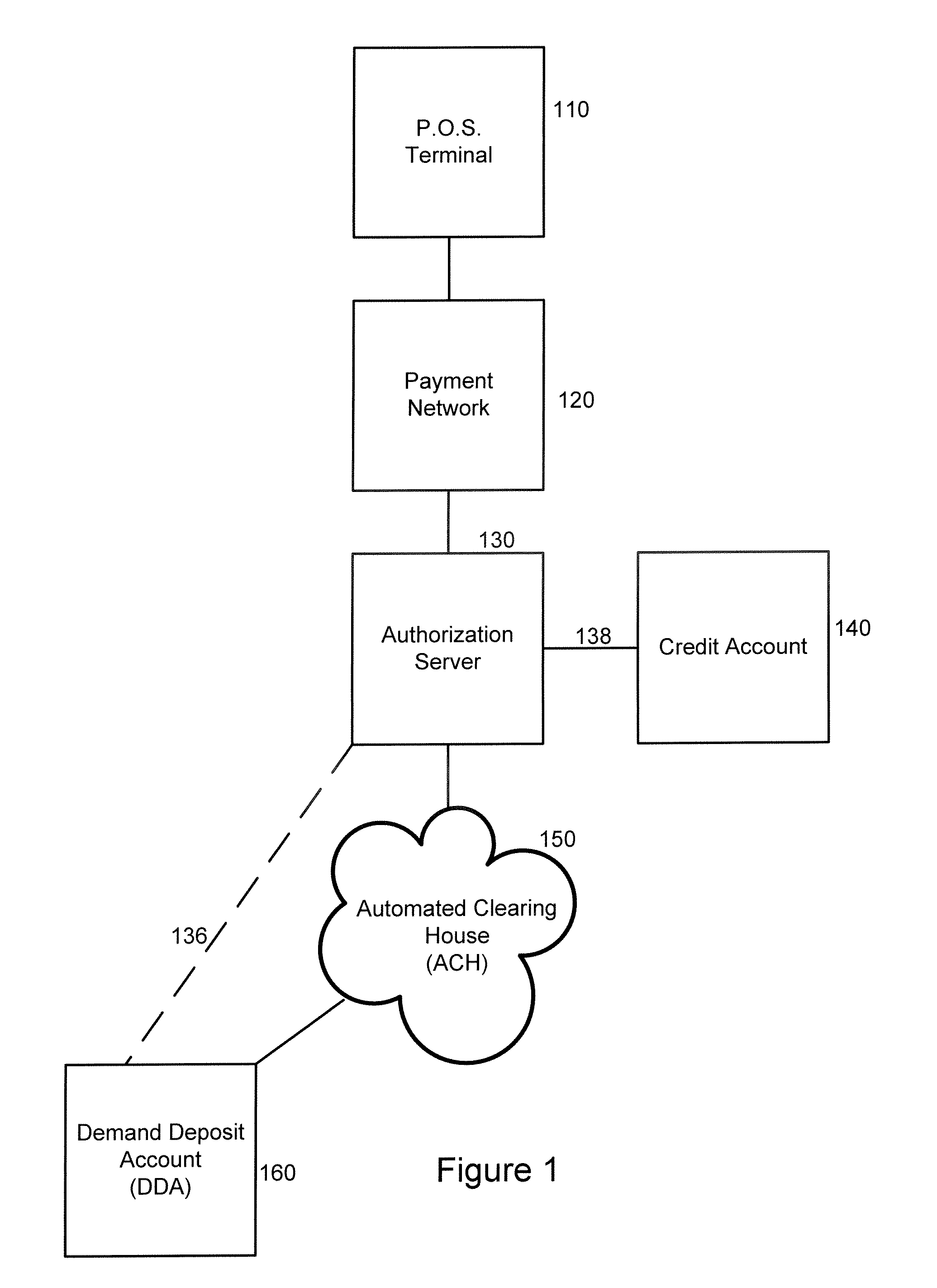

Systems and Methods for Locating an Automated Clearing House Utilizing a Point of Sale Device

InactiveUS20090164325A1Easy to identifyEasy to calculateComplete banking machinesHand manipulated computer devicesThird partyIssuing bank

A point of sale (POS) device may be configured to locate a payment system and transmit a payment authorization request from a remote location to a payment system, either directly, or via a payment system directory and / or a SSL Gateway. The invention also includes inserting third party account information into an encrypted portion of the payment request, so the payment request appears as a normal request to the issuing bank, but the third party account information may be used by the third party to bill the customer. The payment system directory is further configured to determine one or more payment processors to direct a payment authorization request, such that a single transaction may me allocated among multiple payment processors for authorization. Moreover, the payment system directory is able to format alternative payment methods into a format that is able to be processed over existing payment networks.

Owner:LIBERTY PEAK VENTURES LLC +1

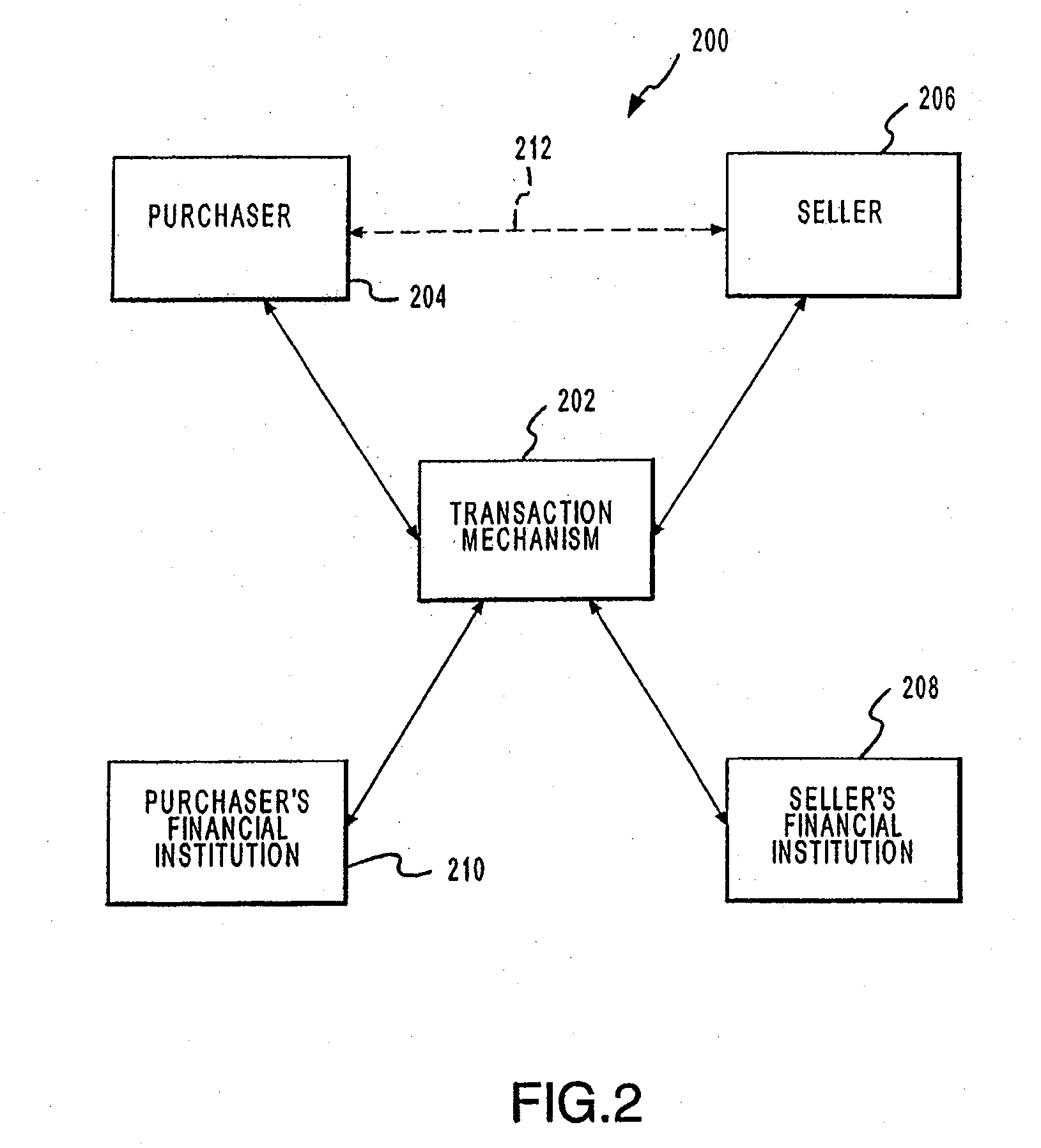

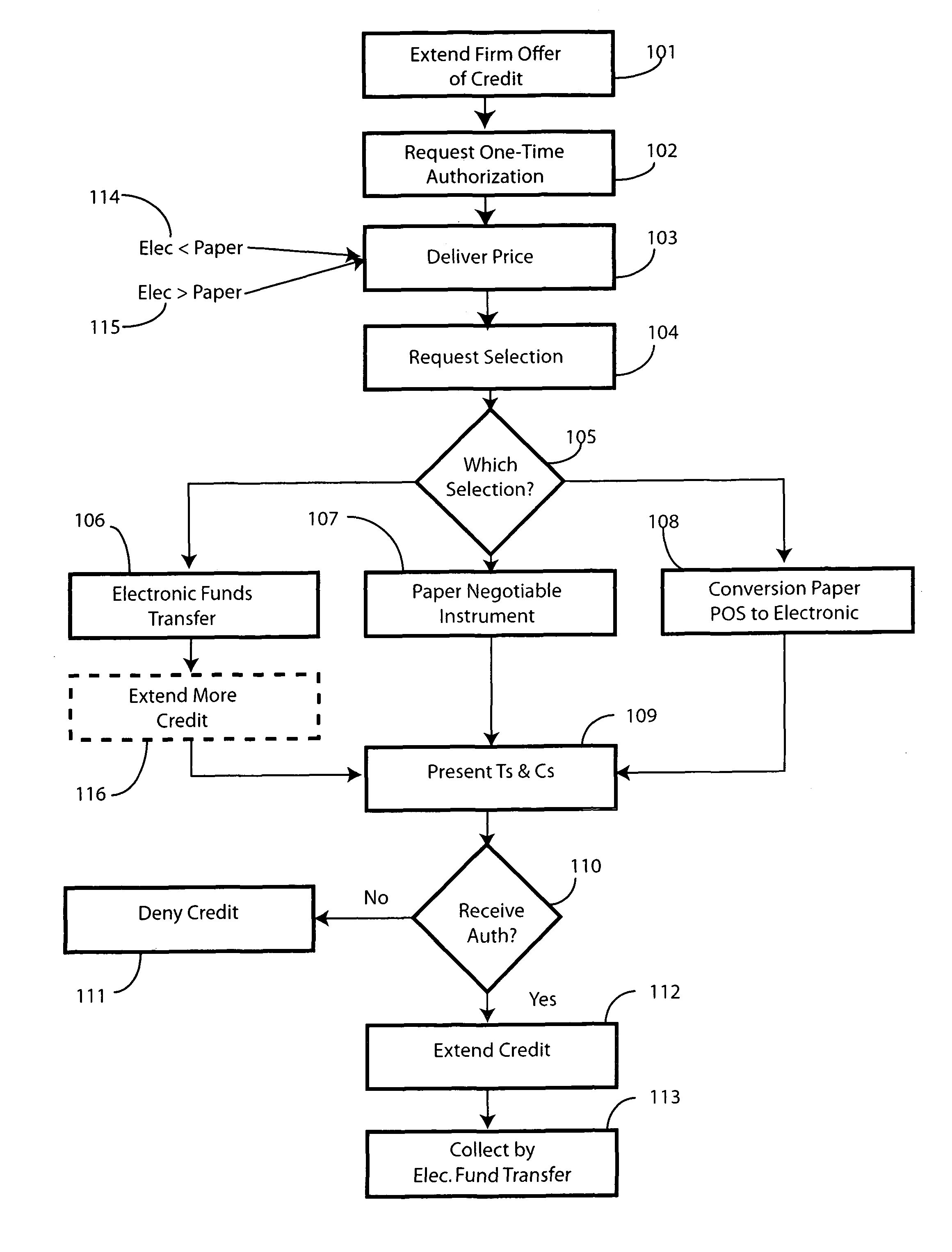

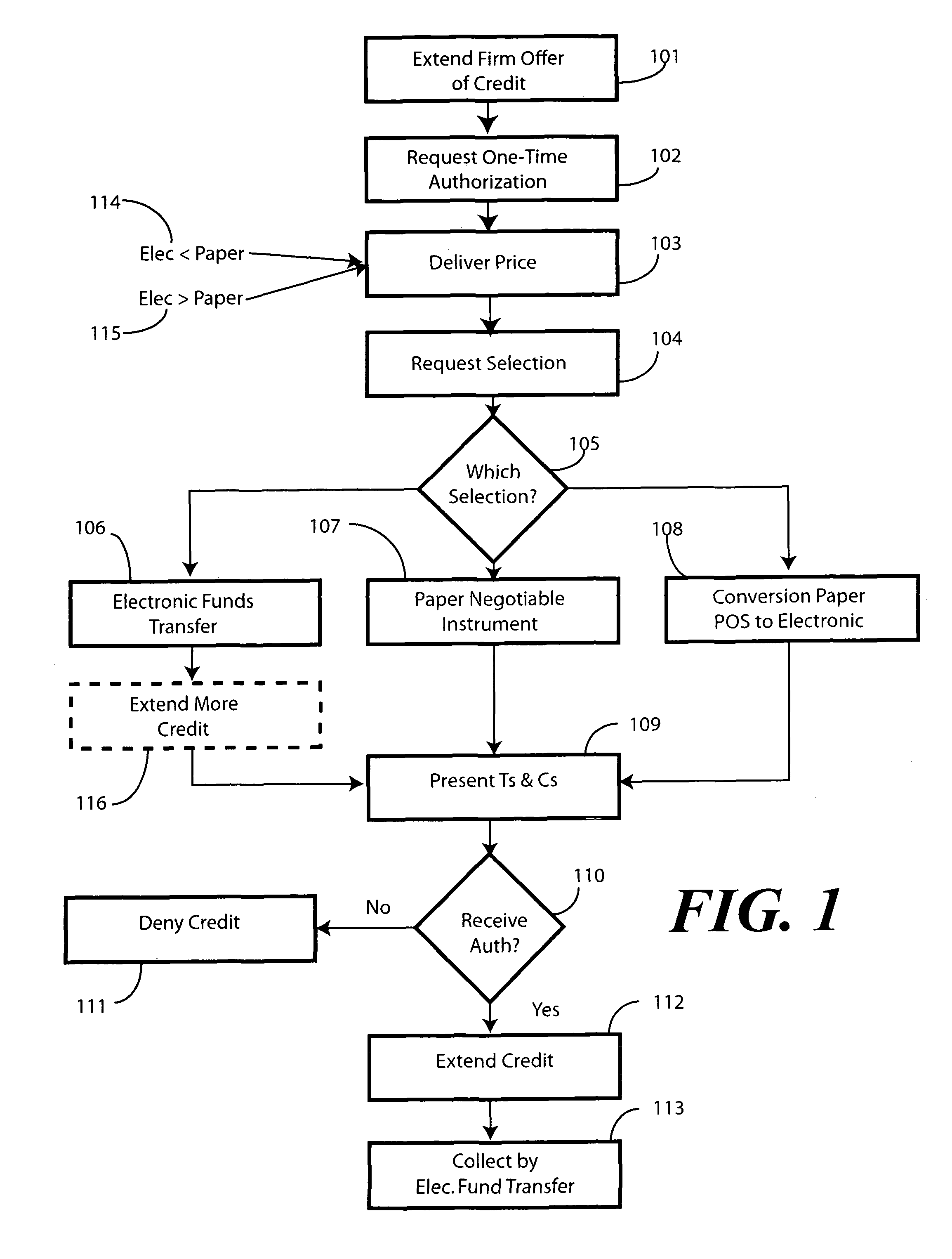

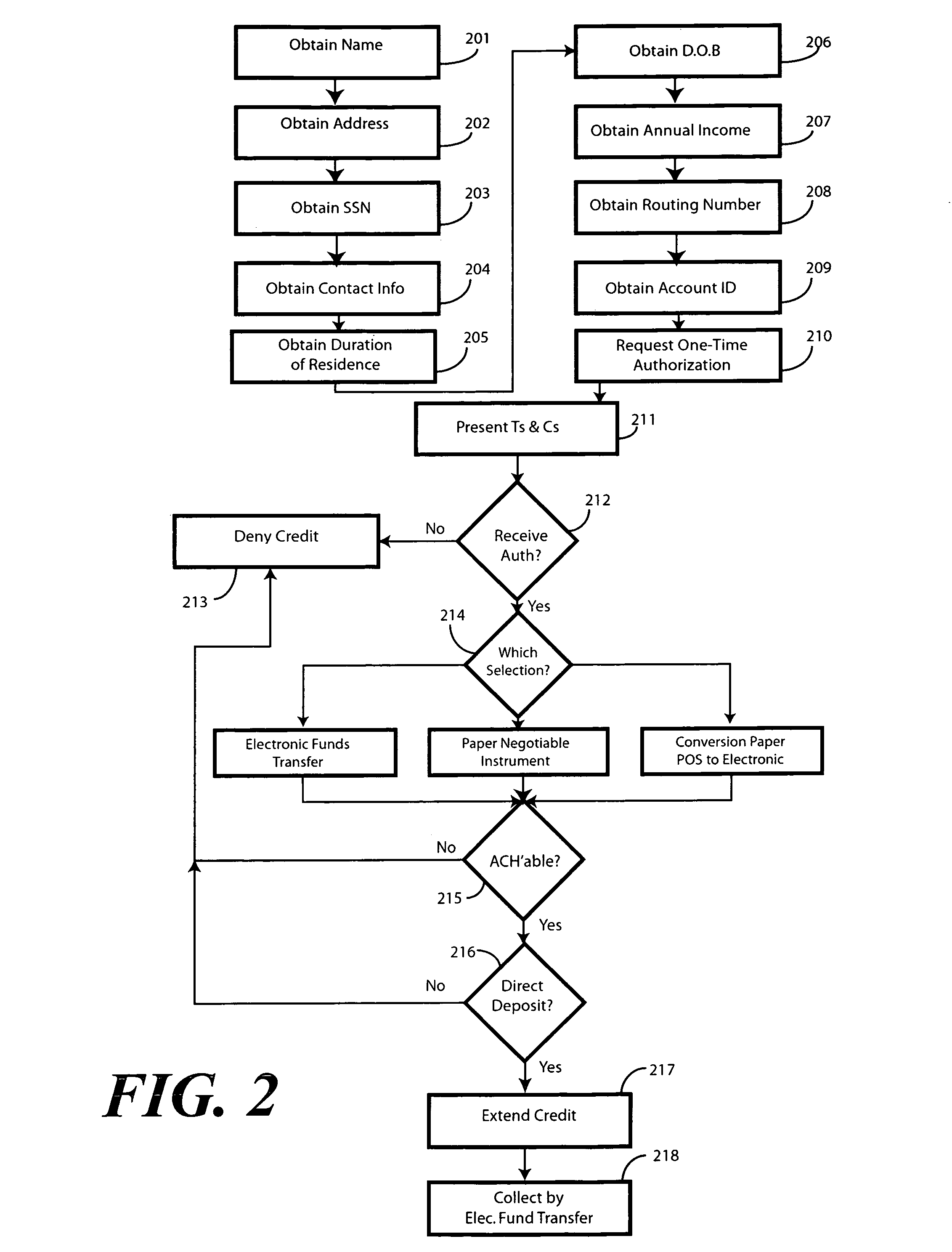

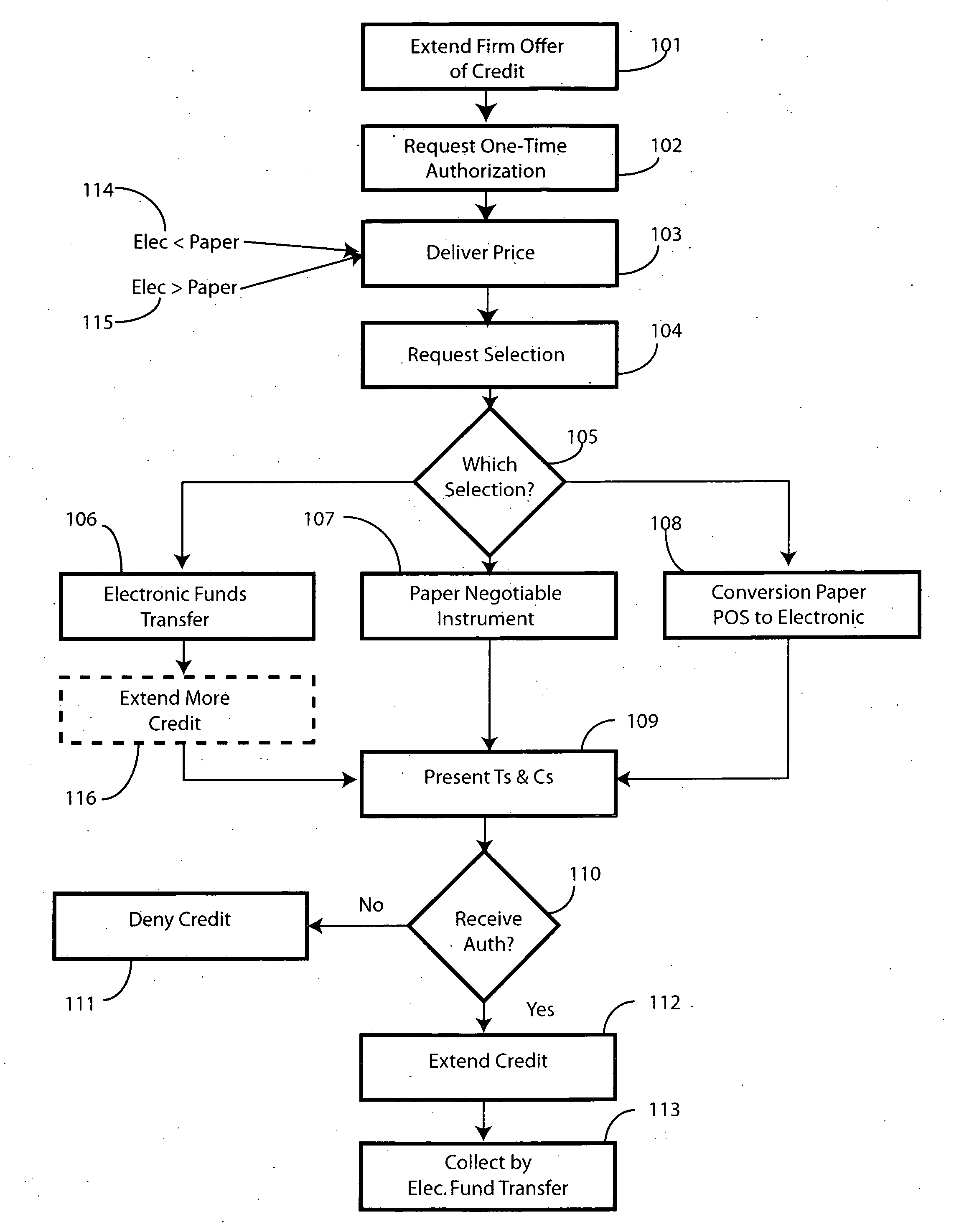

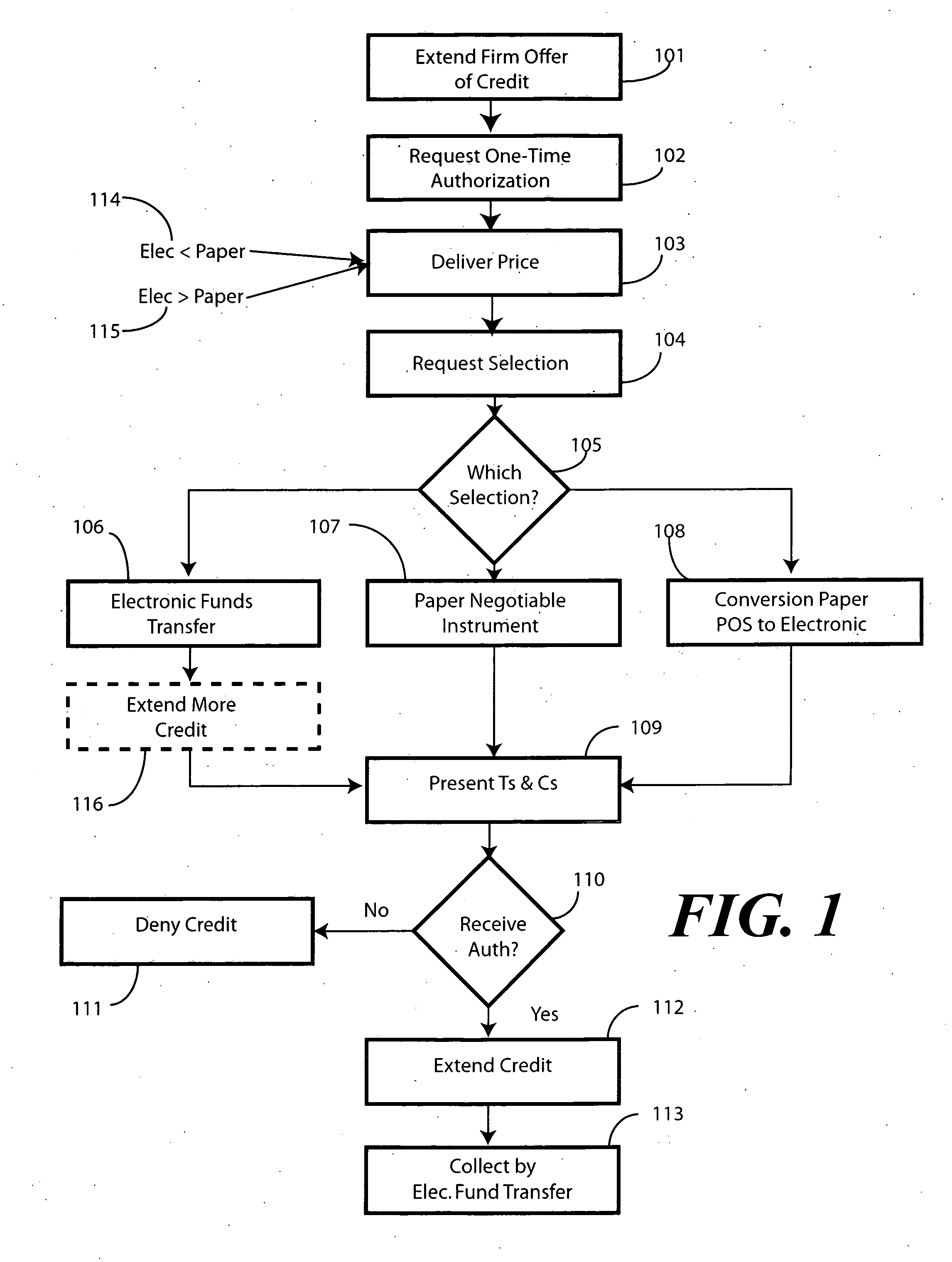

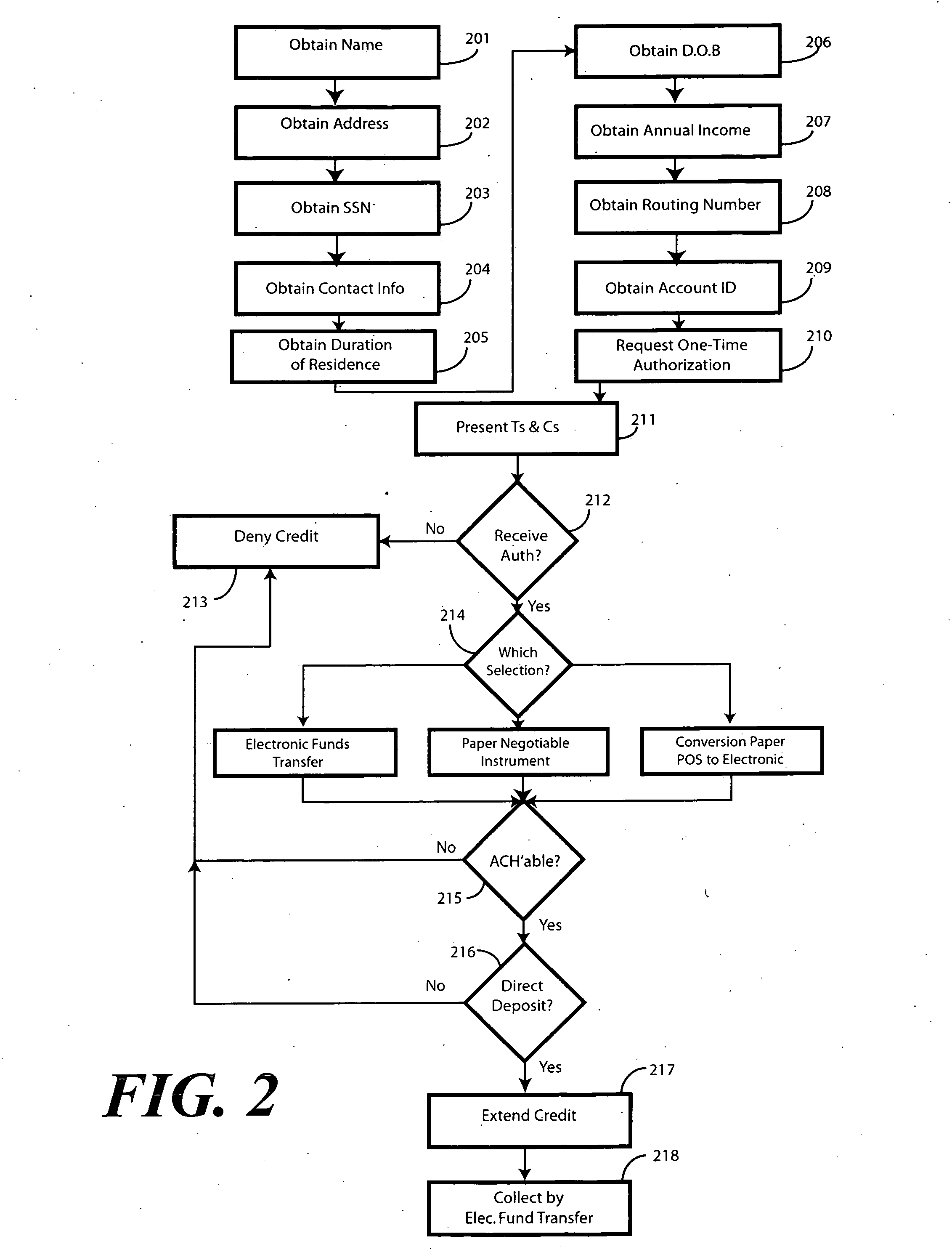

Method and system for extending credit with automated repayment

A system and method for extending a firm offer of credit contingent upon receiving a one-time authorization to execute recurring automatic withdrawals from a deposit account is provided. In providing the one-time authorization to execute recurring automatic withdrawals, a prospective borrower may elect from a plurality of automatic withdrawal repayment options. One such option is electronic fund transfer, such as the initiation of a withdrawal entry into the Automated Clearing House network. A second option is by the remote creation of a paper negotiable instrument, which is then converted into an electronic substitute check capable of electronic routing. Upon receiving the one-time authorization, the lender may make recurring automatic withdrawals from the borrower's deposit account.

Owner:CC SERVE

Non-cash transaction incentive and commission distribution system

An electronic fund transfer system is disclosed wherein commissions for point-of-sale purchase transactions are determined and distributed to members of an organizational network for promoting use of a non-cash payment device for effecting purchase transactions. Purchase data is electronically transmitted from the point-of-sale to an automated clearing house for effecting fund transfers to prepare the purchase, and also to a commission management system. The commission management system maintains an electronic database reflecting the structure of the organizational network, and further determines the distribution of purchase commissions according to a predetermined schedule of proportions relating to the position and business volume of each member of the network. The commission management system further comprises a payment processor for effecting commission payments to the members or to a designated sponsor on a scheduled basis.

Owner:MASI LARRY A

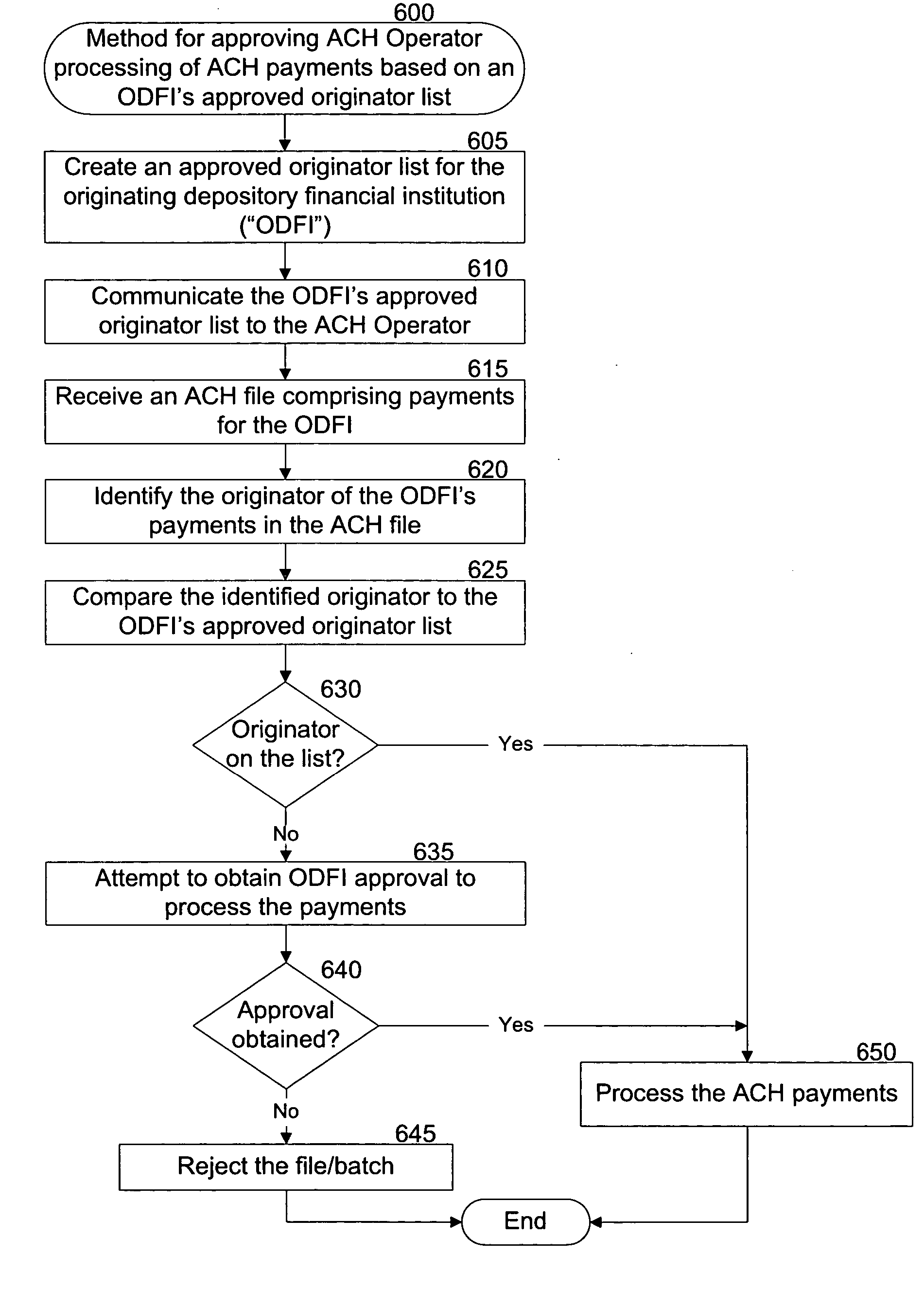

Approving ACH operator processing of ACH payments based on an originating depository financial institution's approved originator list

Approving automated clearing house (“ACH”) payments for processing by an ACH operator is based on an approved originator list identifying originators authorized by an originating depository financial institution (“ODFI”) to originate ACH payments and to send those ACH payments to the ACH operator on behalf of the ODFI. The ACH operator receives an ACH payment originated by a first originator and sent to the ACH operator on behalf of the ODFI. The ACH operator determines whether the first originator is on the approved originator list and processes the ACH payment if the first originator is on the approved originator list. The ACH operator can reject the ACH payment if the first originator is not on the approved originator list or can seek approval from the ODFI to process the ACH payment even if the first originator is not on the approved originator list.

Owner:US FEDERAL RESERVE BANK OF ATLANTA

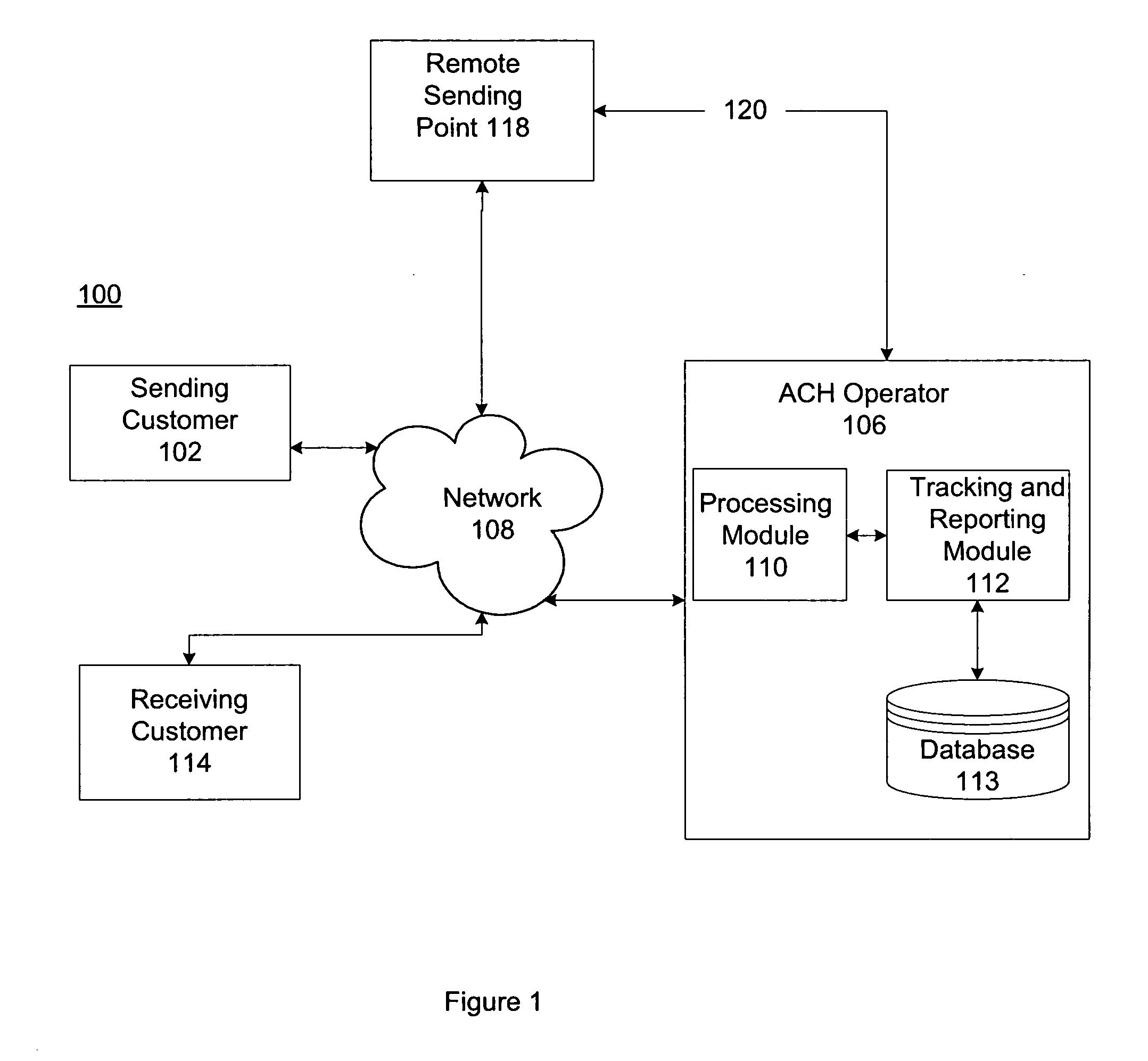

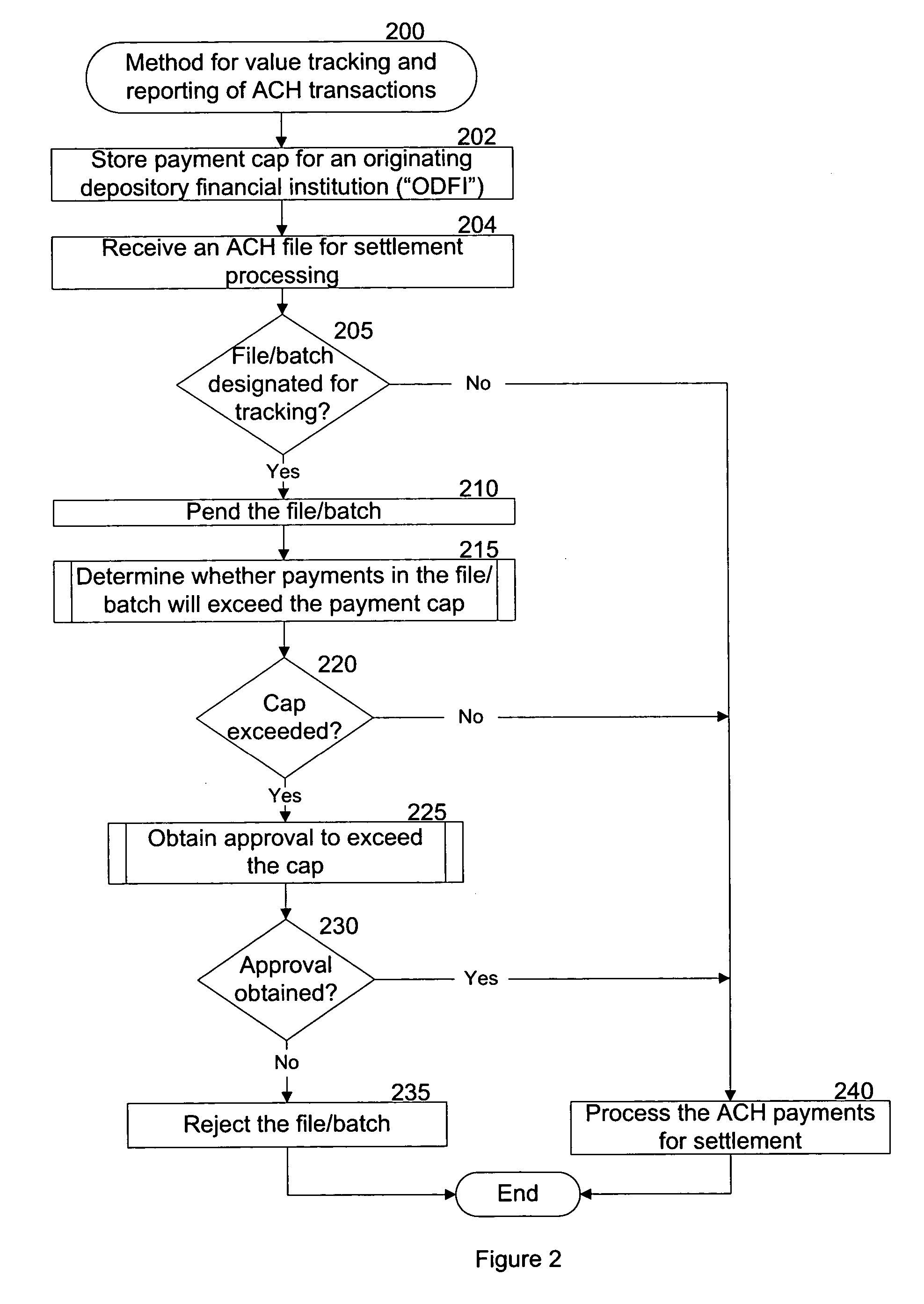

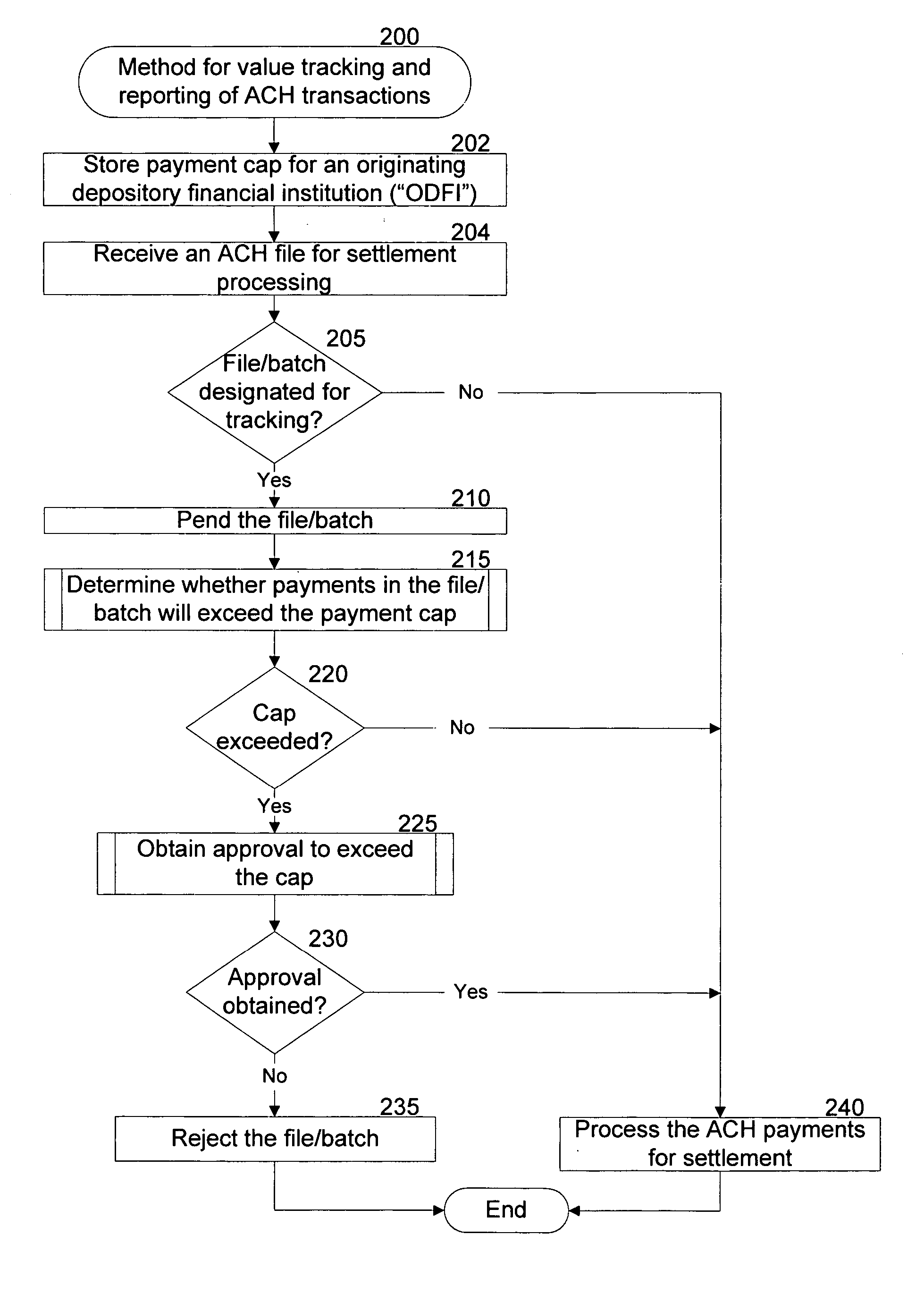

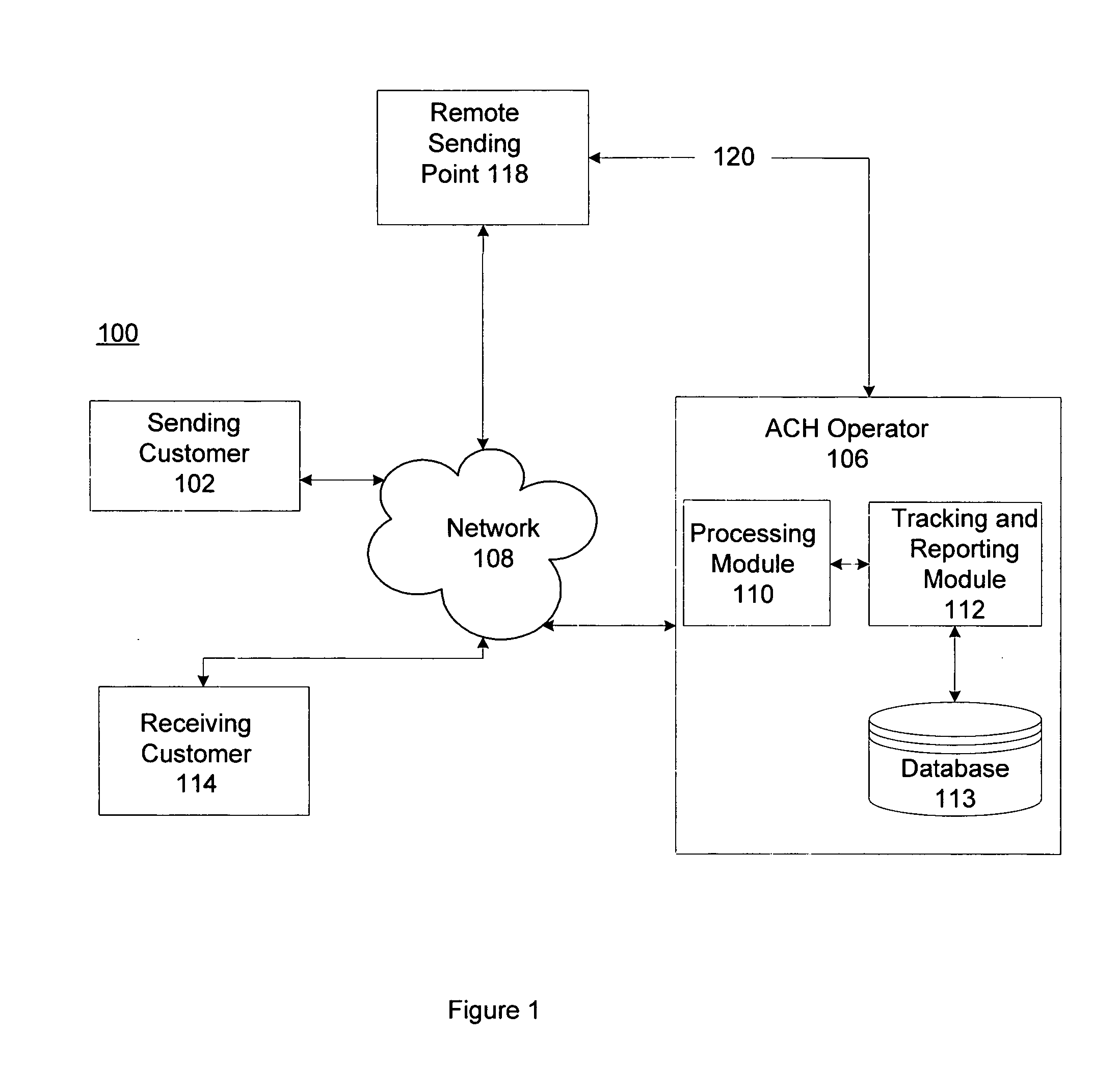

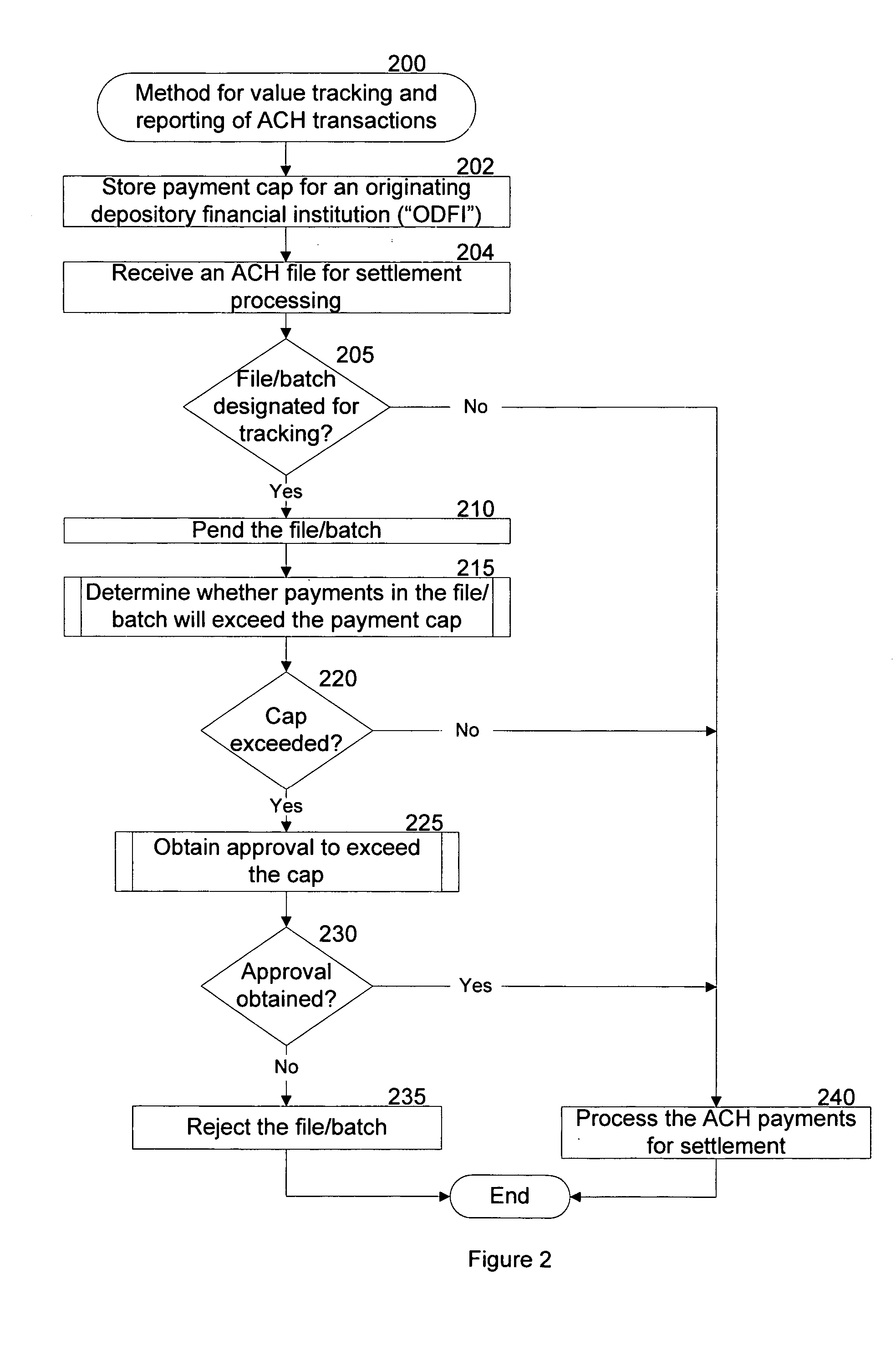

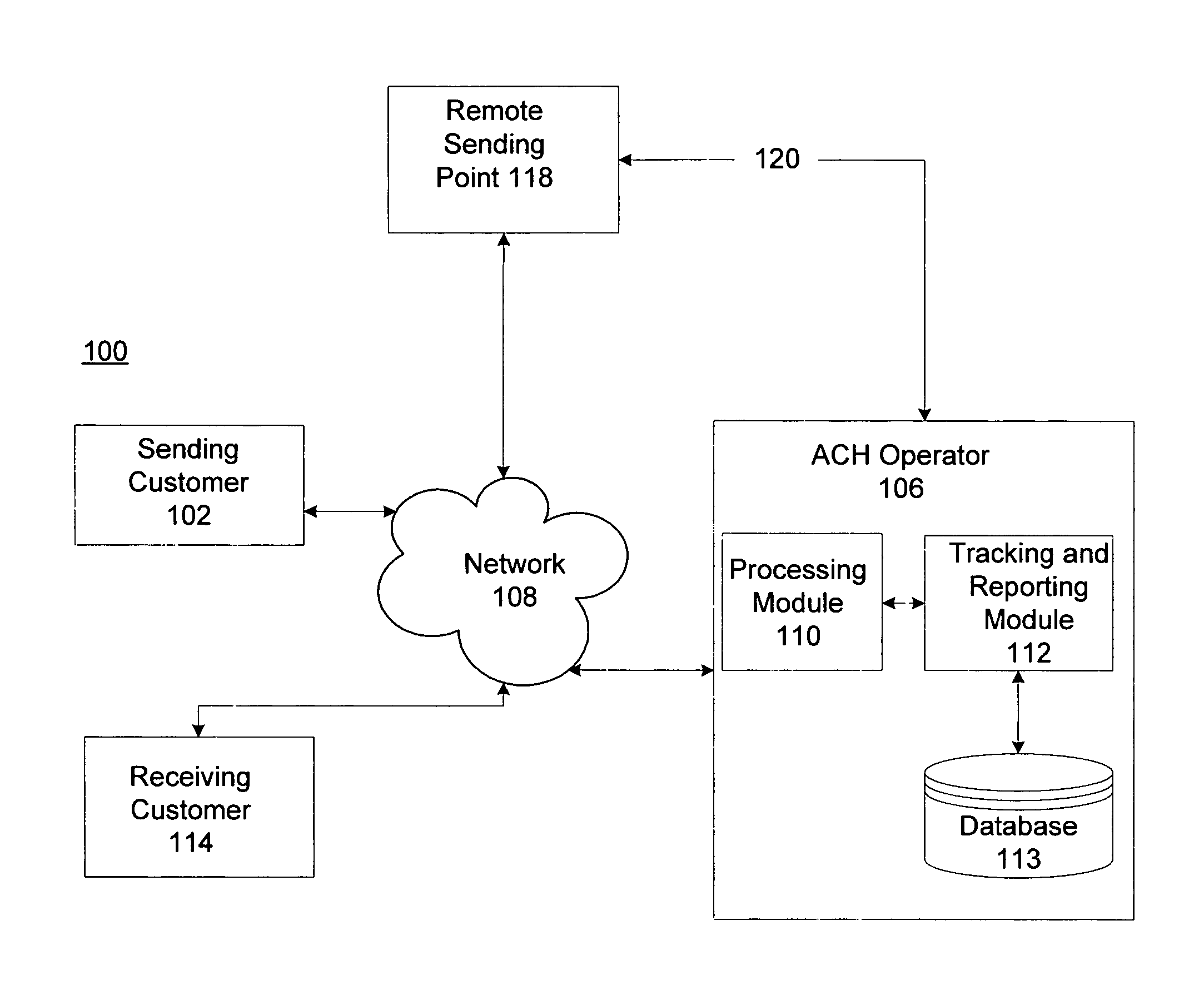

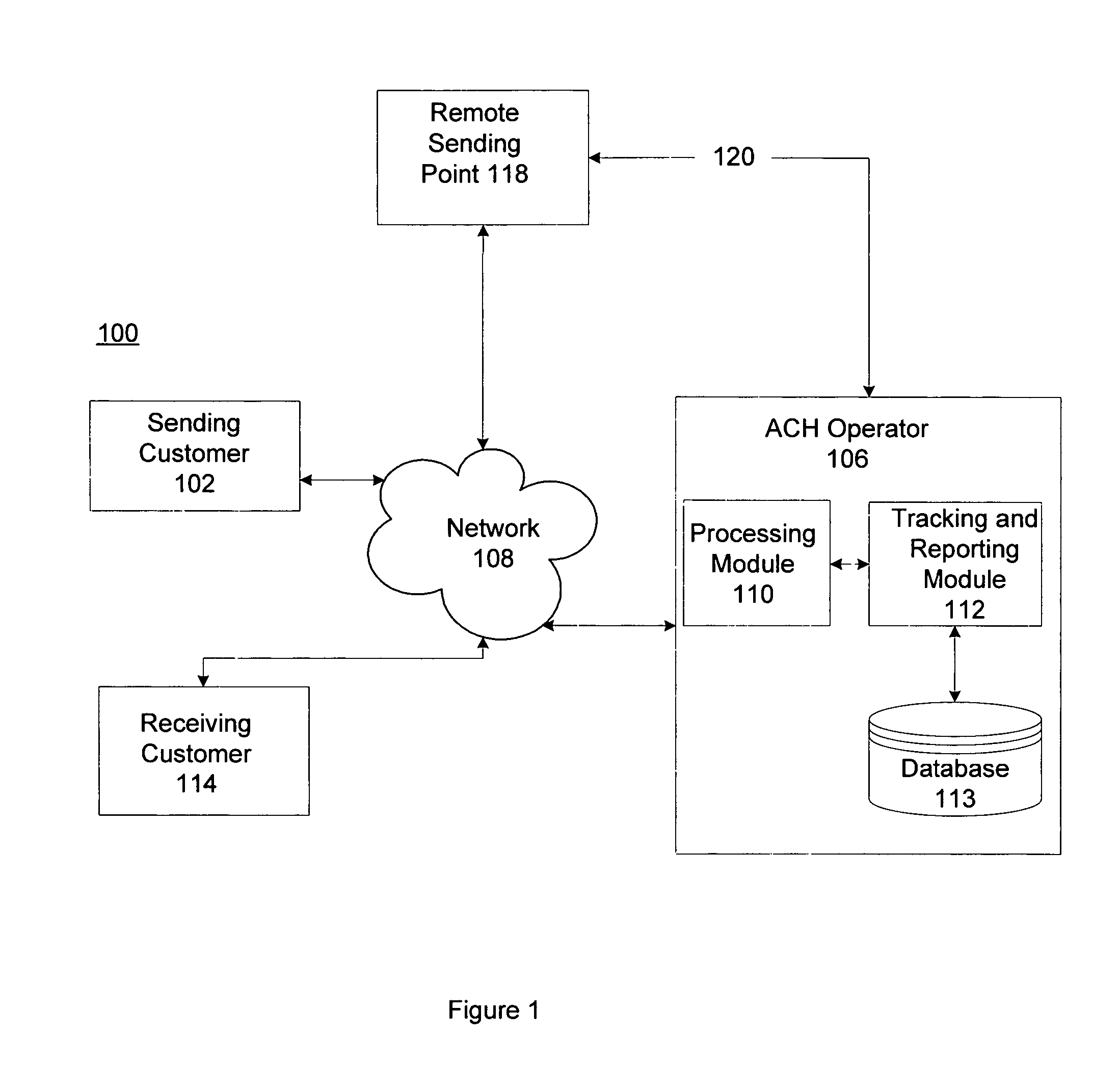

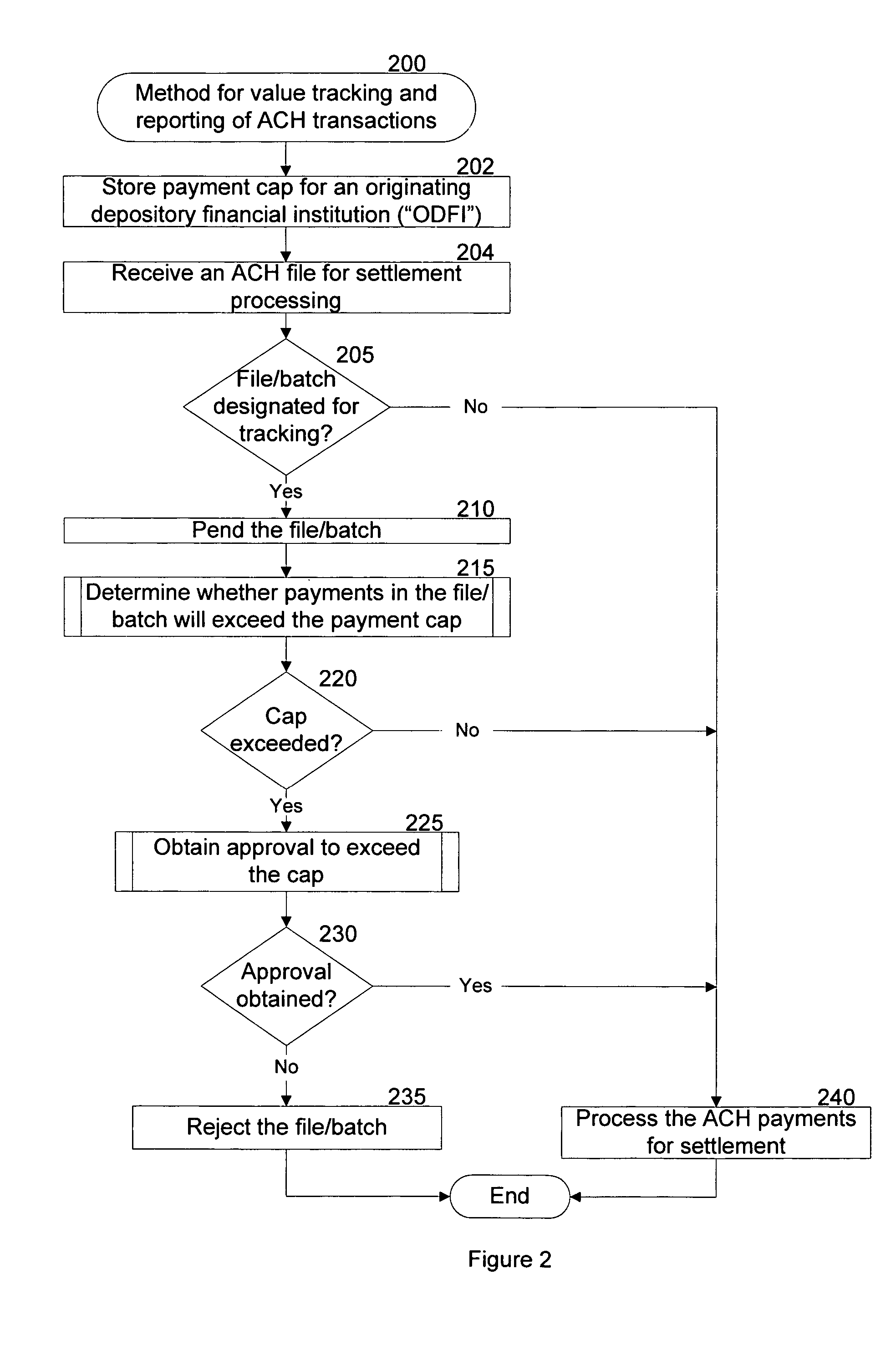

Value tracking and reporting of automated clearing house transactions

Value tracking of automated clearing house (“ACH”) payments processed by an ACH operator includes receiving an ACH file for ACH processing. The ACH file comprises ACH payments originated by a remote sending point on behalf of a sending customer. A sum value of the ACH payments is added to a value of prior payments processed for the sending customer during a specified time period to obtain an accumulated payment value. The accumulated payment value is compared to a pre-established payment cap to determine whether the accumulated payment value exceeds the payment cap. The ACH payments are processed in response to a determination that the accumulated payment value does not exceed the payment cap. Whether to override the payment cap can be determined in response to a determination that the accumulated payment value exceeds the payment cap.

Owner:US FEDERAL RESERVE BANK OF ATLANTA

Searching for and identifying automated clearing house transactions by transaction type

Identifying automated clearing house (“ACH”) transaction items processed by an ACH operator comprises processing ACH items for acceptance by the ACH operator. Each ACH item relates to an ACH transaction type. Each ACH item is associated with a corresponding ACH transaction type to which it is related. Each ACH item also is associated with parties involved in the transaction detailed in the ACH item. A request for information regarding a specified ACH transaction type is received from a requesting party. ACH items associated with the specified ACH transaction type and the requesting party are identified in response to receiving the request. Information regarding the identified ACH items is presented to the requesting customer.

Owner:US FEDERAL RESERVE BANK OF MINNEAPOLIS +1

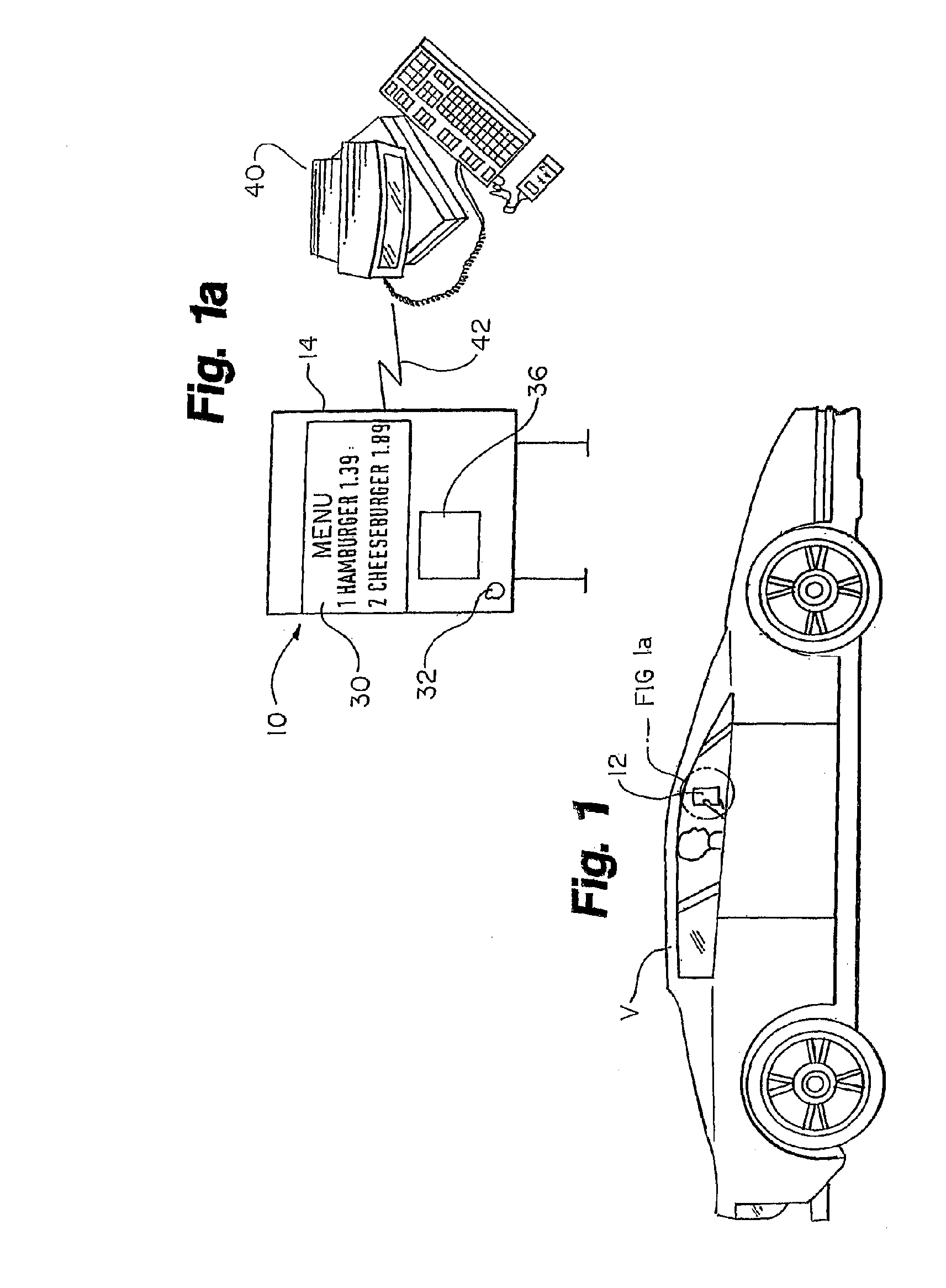

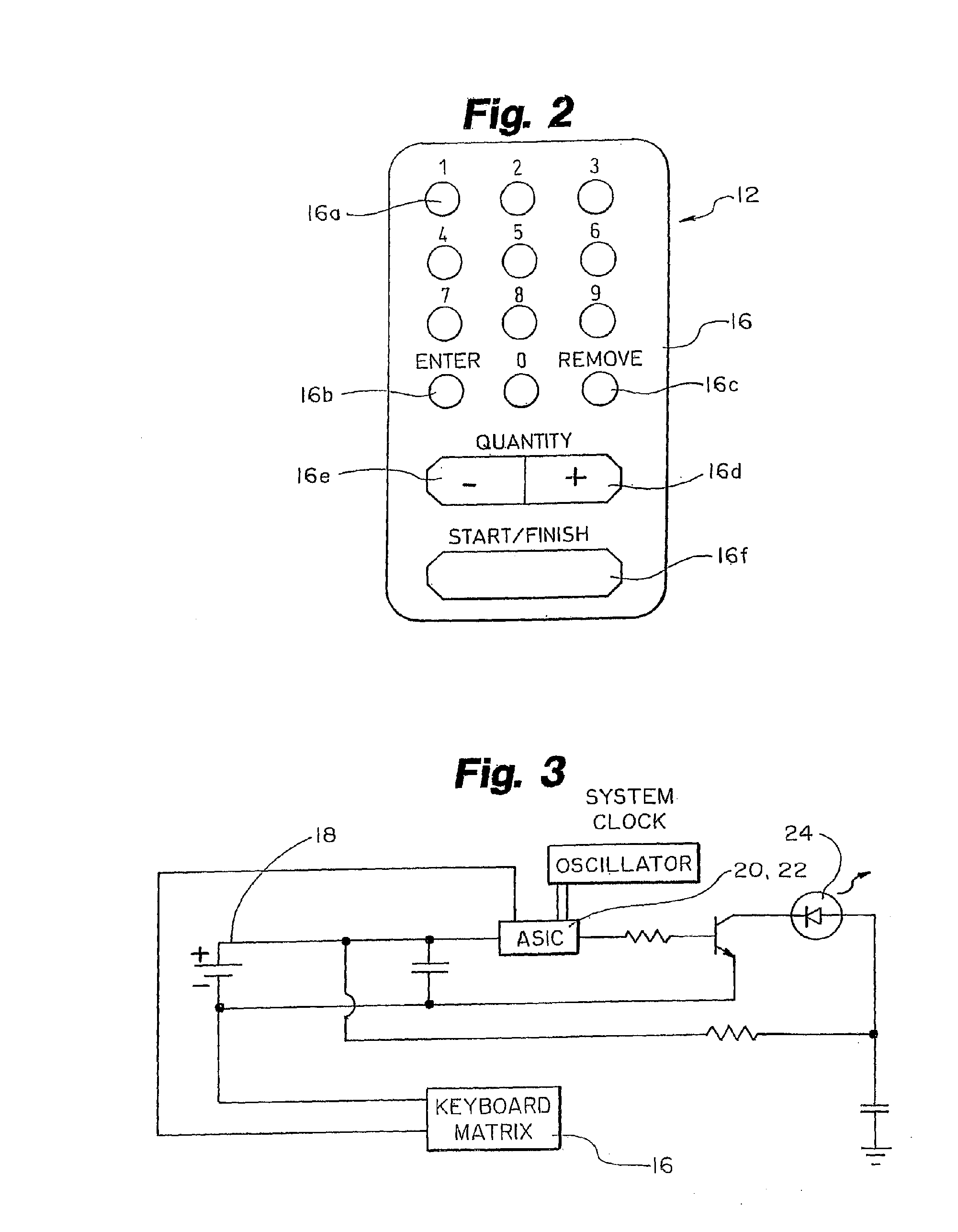

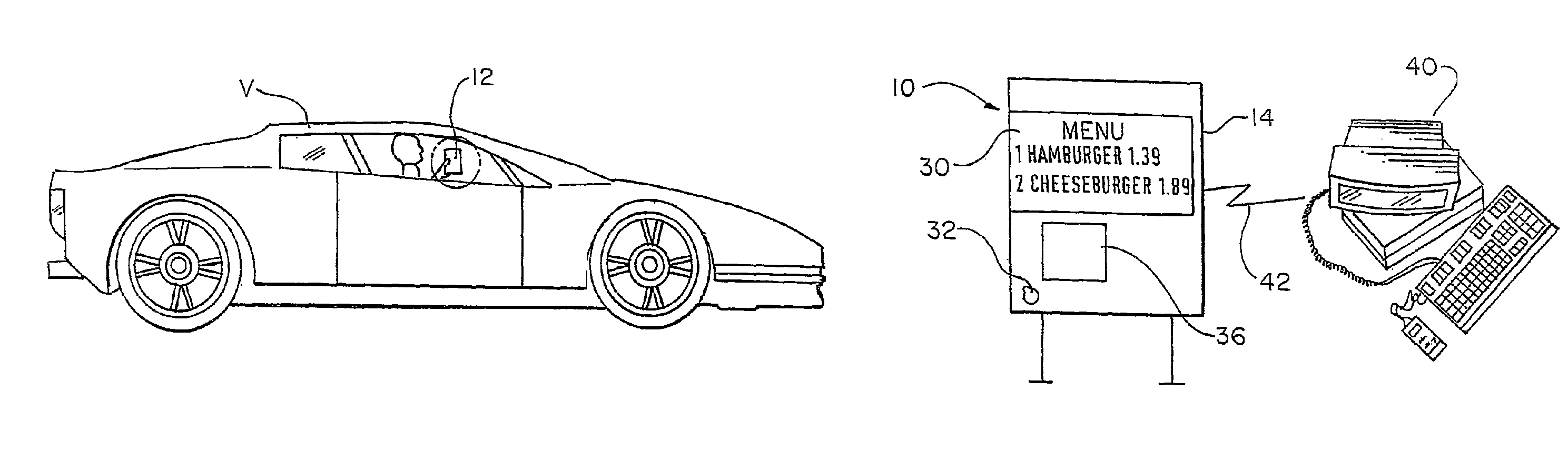

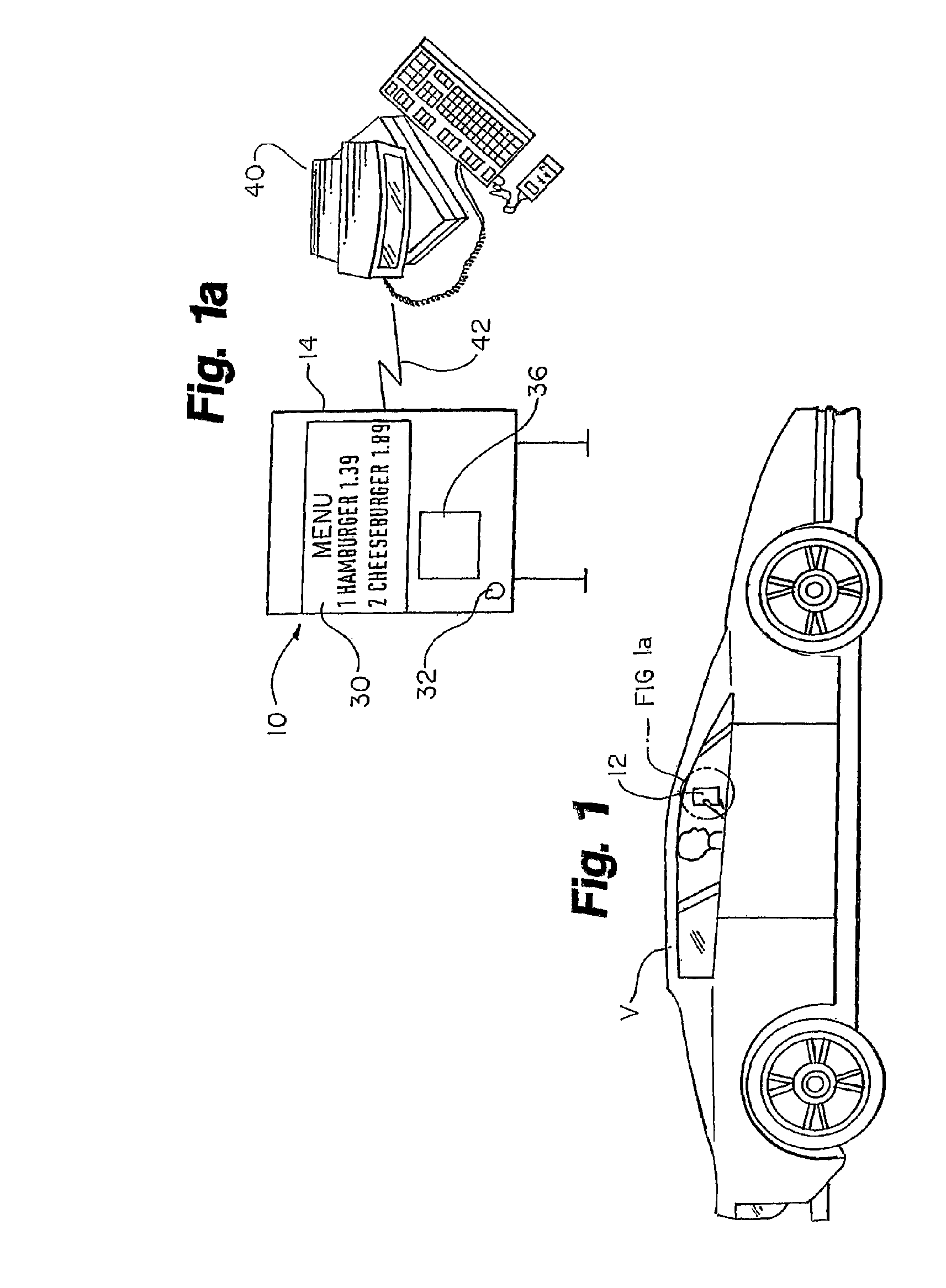

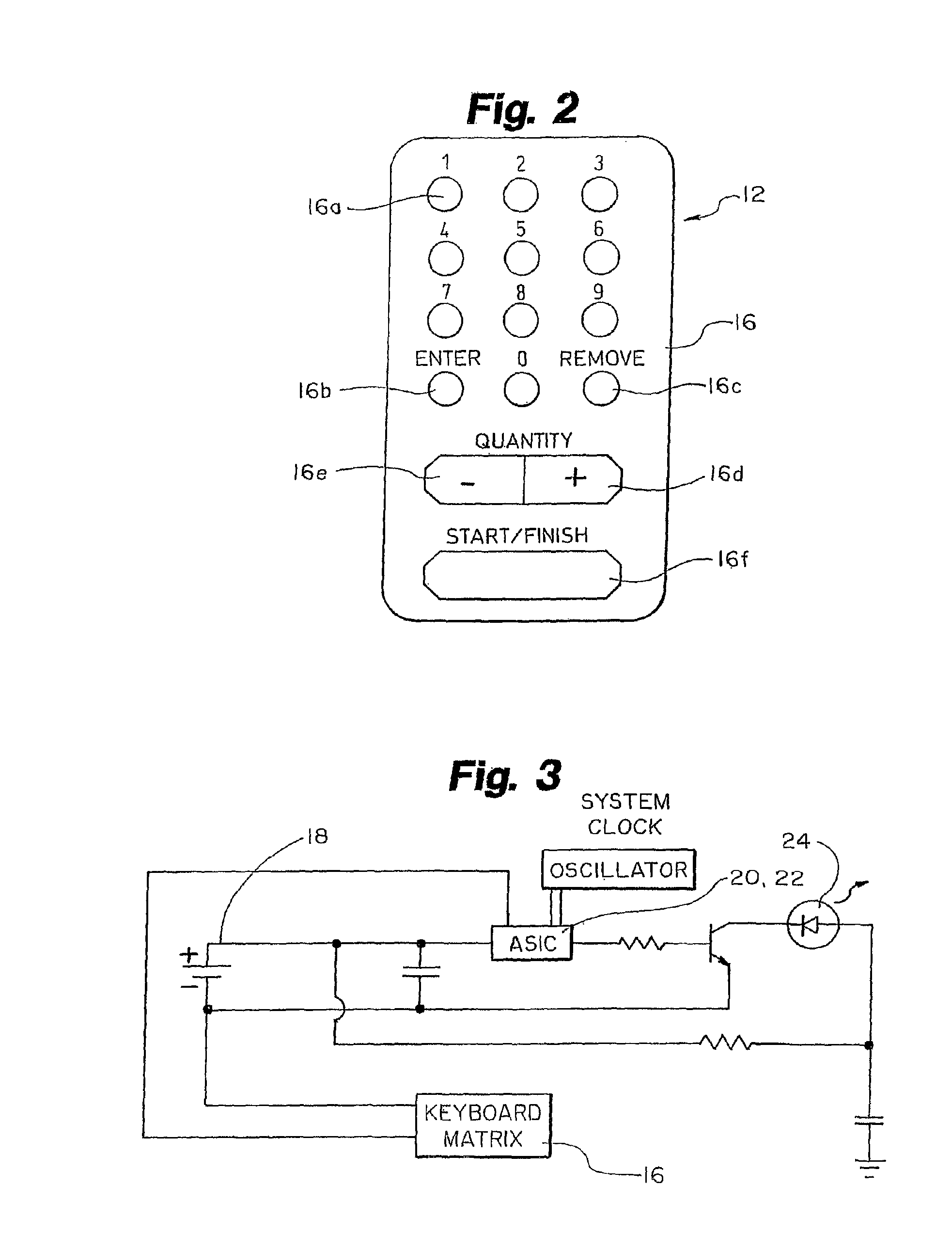

Remote ordering device

InactiveUS20070239565A1Correct orderSave labor costsComplete banking machinesTicket-issuing apparatusWi-FiThe Internet

A remote ordering device having a two-way wireless communications input device with a display for sending and receiving data and a data receiving station to send and receive data, process orders and keep track of accounts, inventory and retain other data as required. The receiving station can be in communication with other receiving stations to forward orders or data. The receiving station can provide instructions to a person or machine to fill orders at any desired location. The remote ordering device can scan in checks or present an electronic version of a check to the data receiving station for payment through an automated clearing house. The two-way communications can be by cell phone through a telephone network alone or also through the internet to the data receiving station. The communications can also be through Wi-Fi and the internet and use a PDA or a computer for data input and reading.

Owner:REMOTE

Non-cash transaction incentive and commission distribution system

An electronic fund transfer system is disclosed wherein commissions for point-of-sale purchase transactions are determined and distributed to members of an organizational network for promoting use of a non-cash payment device that is tangible for effecting purchase transactions. Purchase data is electronically transmitted from the point-of-sale to an automated clearing house for effecting fund transfers to prepare the purchase, and also to a commission management system. The commission management system maintains an electronic database reflecting the structure of the organizational network, and further determines the distribution of purchase commissions according to a predetermined schedule of proportions relating to the position and business volume of each member of the network. The commission management system further comprises a payment processor for effecting commission payments to the members or to a designated sponsor on a scheduled basis.

Owner:MASI LARRY A

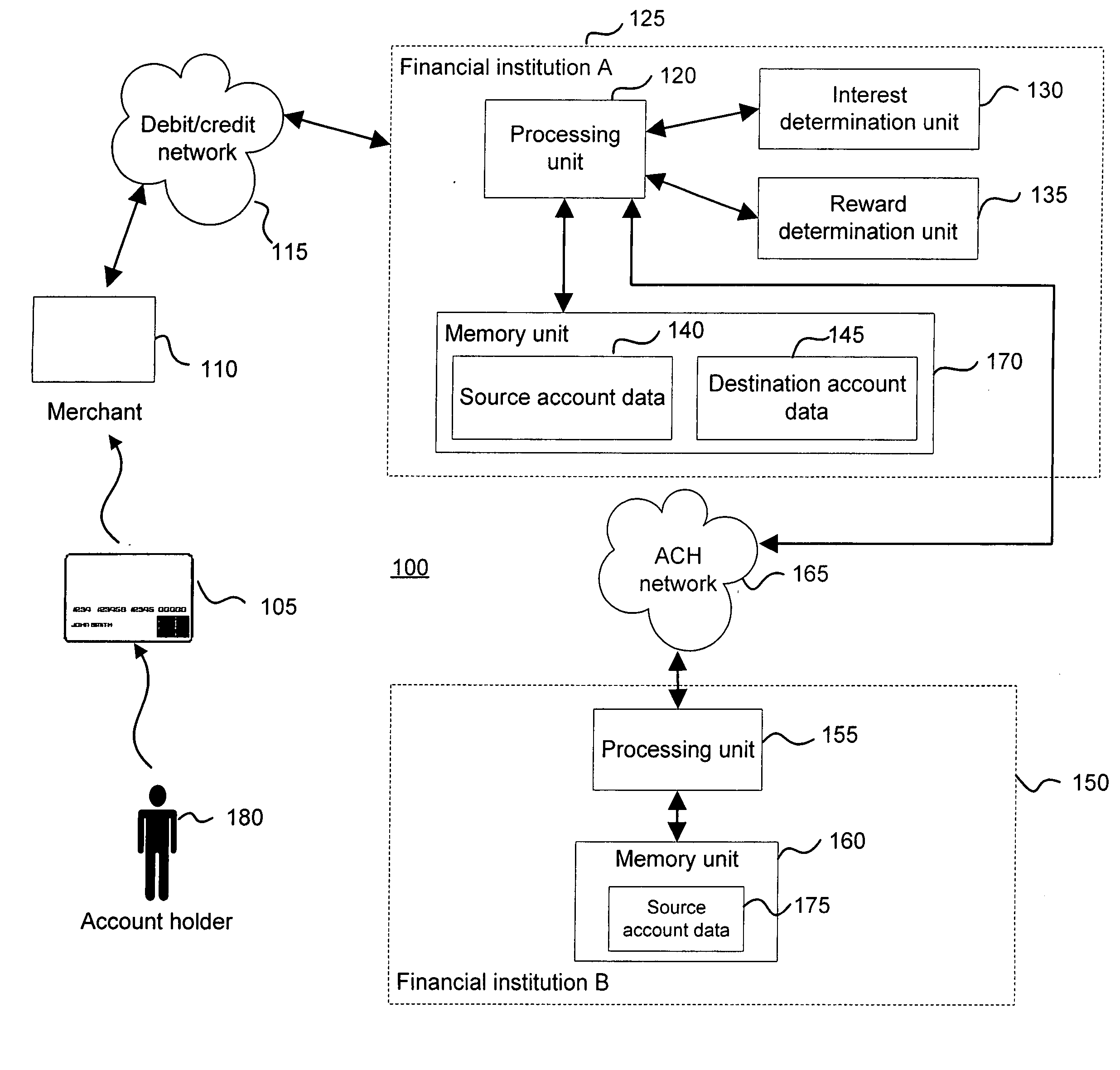

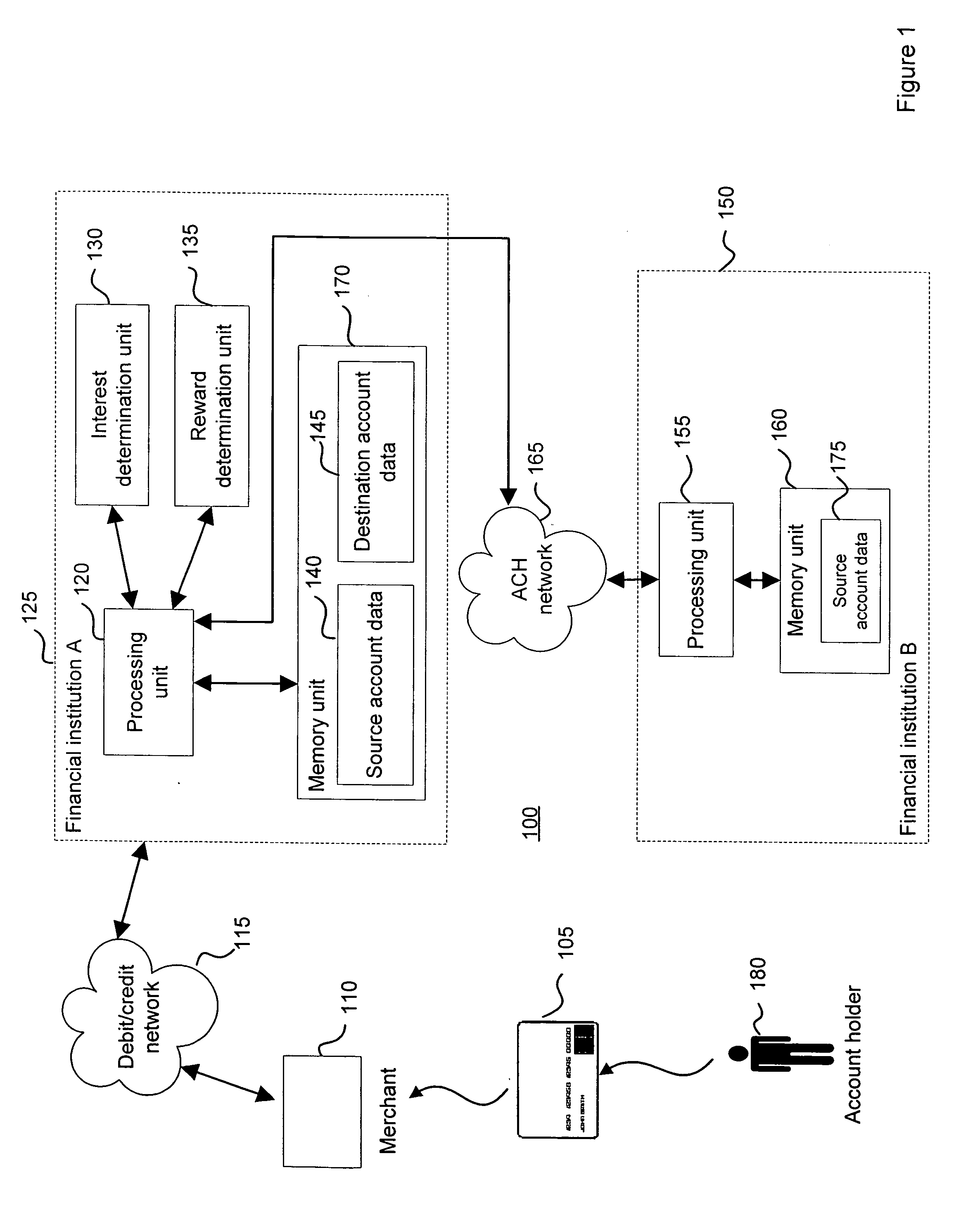

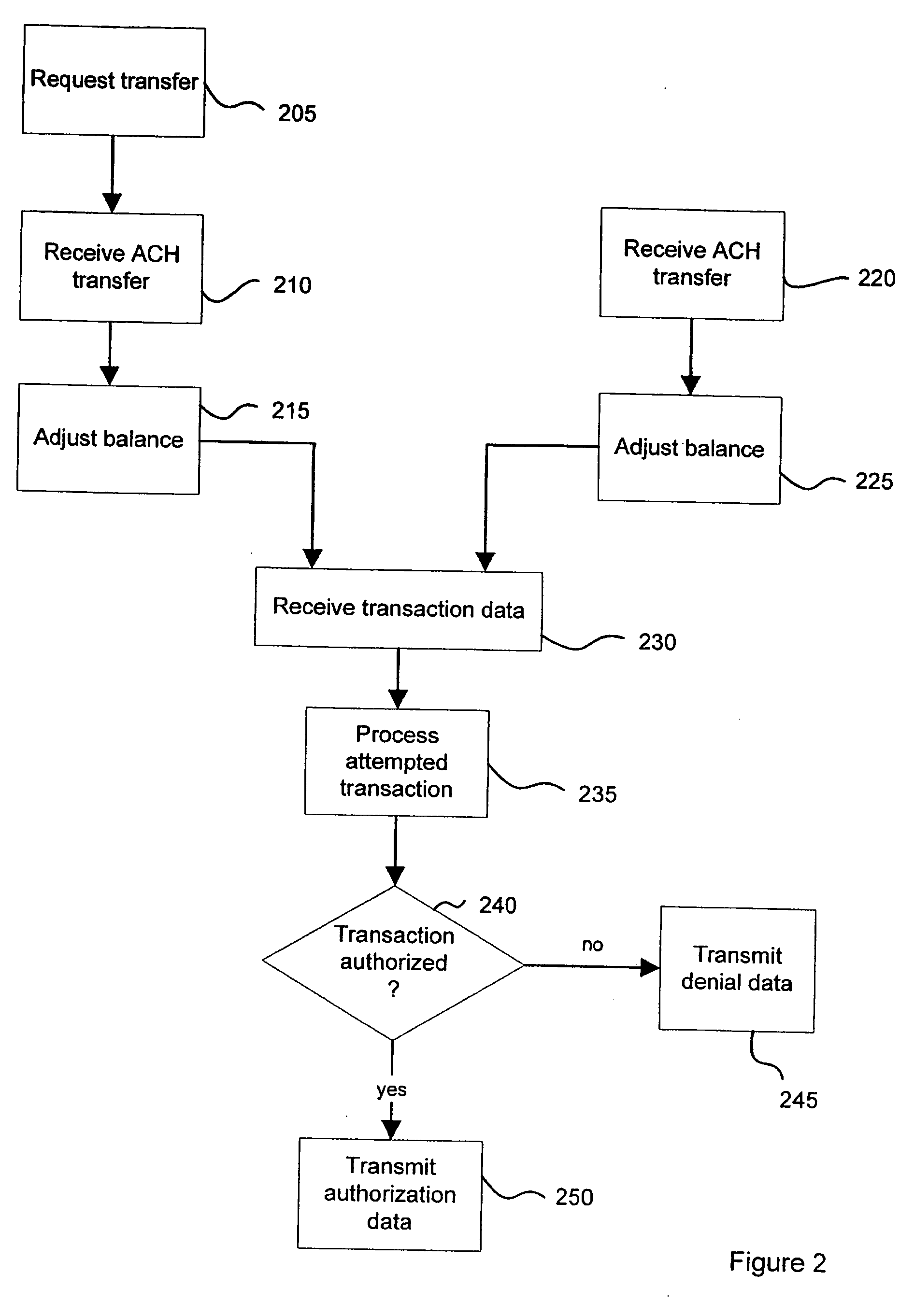

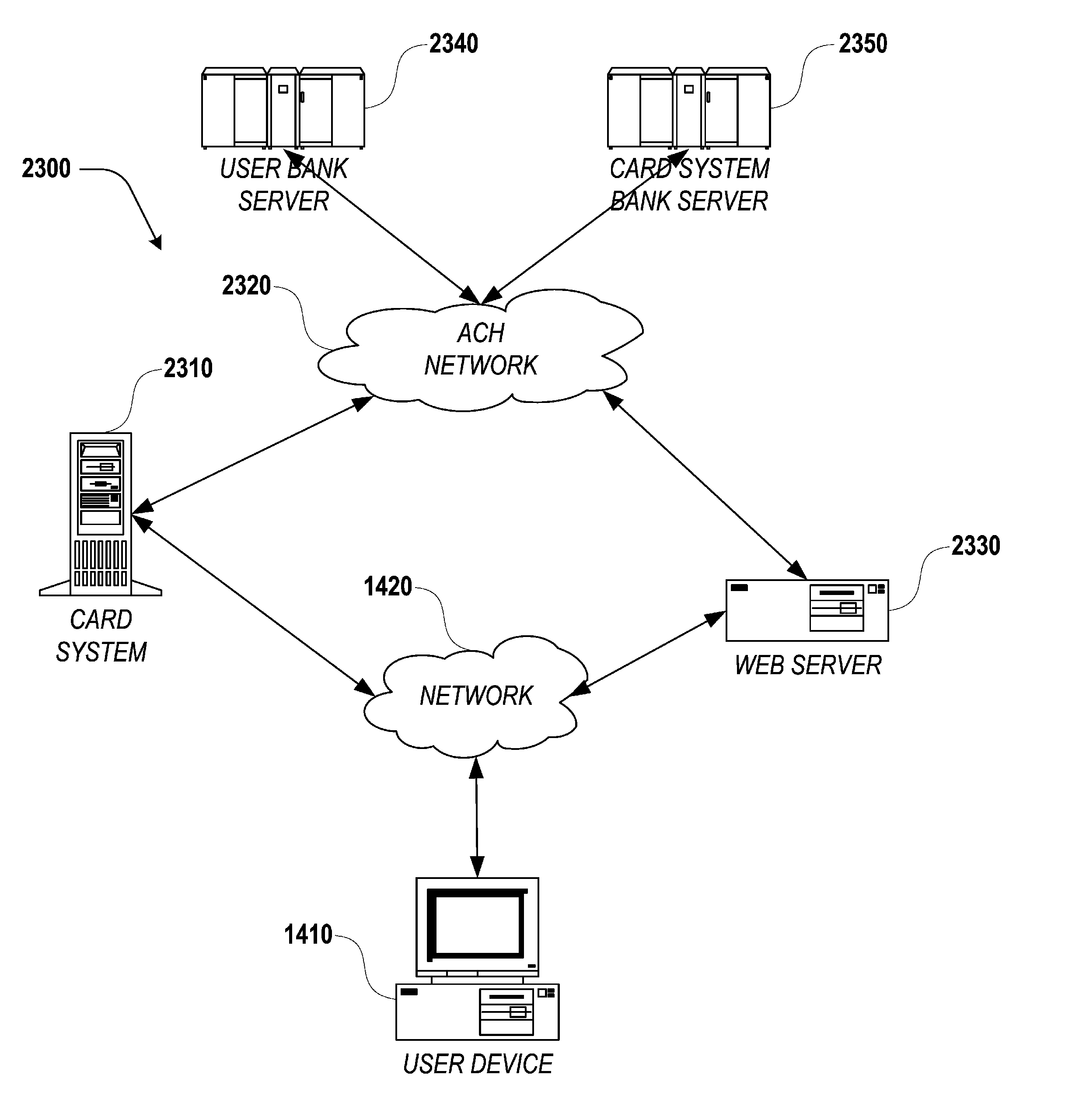

System and method for processing and for funding a transaction

Method for processing a transaction, the method comprising automatically requesting an automated clearing house transfer from a source account to a destination account via an automated clearing house network, receiving the automated clearing house transfer, adjusting destination account data associated with the destination account by increasing a balance of the destination account by an amount of the transfer, receiving transaction data from a merchant indicating an attempted transaction, the transaction data including a transaction amount and data identifying the destination account, processing the attempted transaction with a credit card interchange rate, and transmitting data to the merchant indicating one of authorization of the attempted transaction and denial of the attempted transaction.

Owner:CAPITAL ONE SERVICES

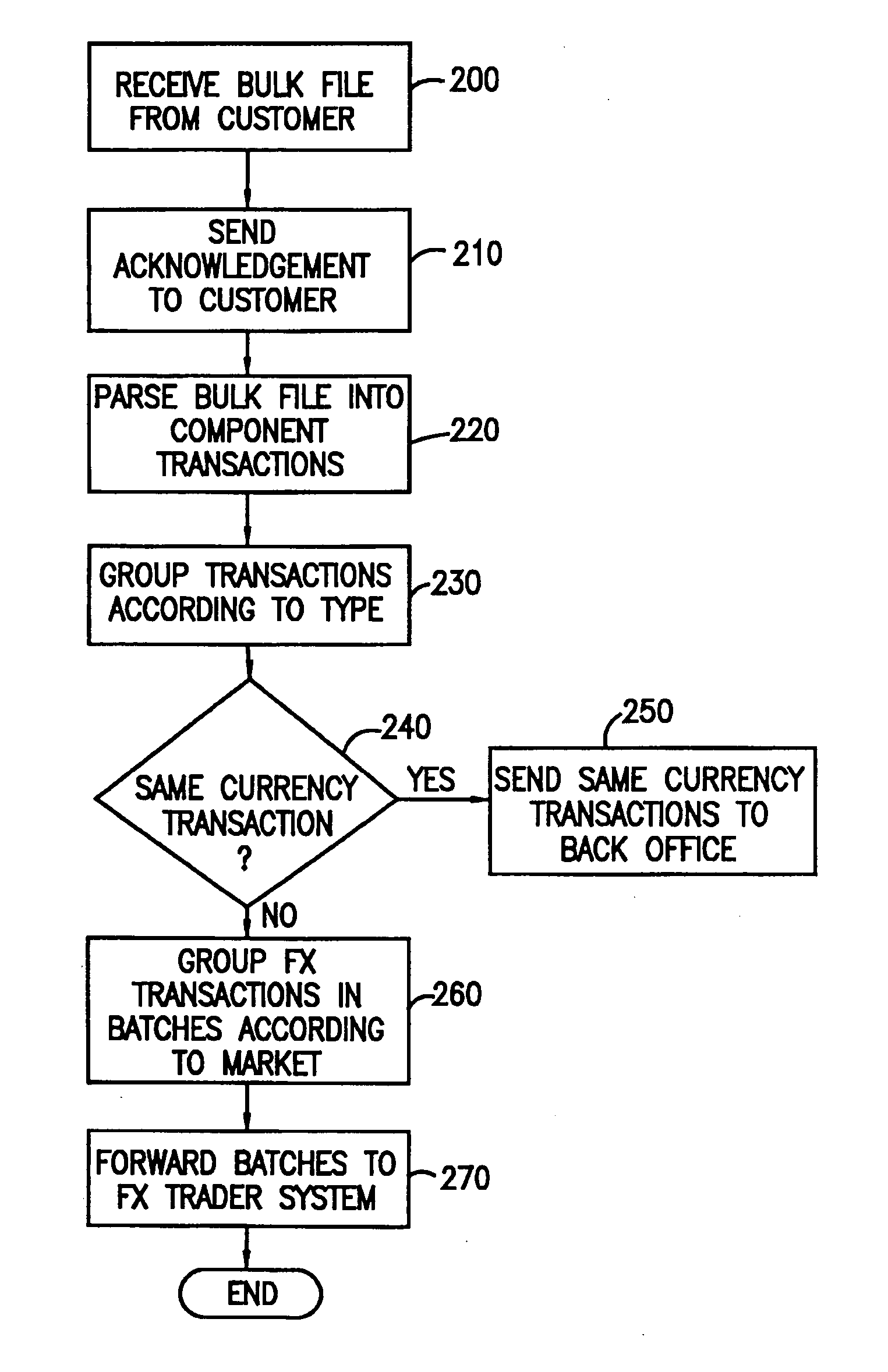

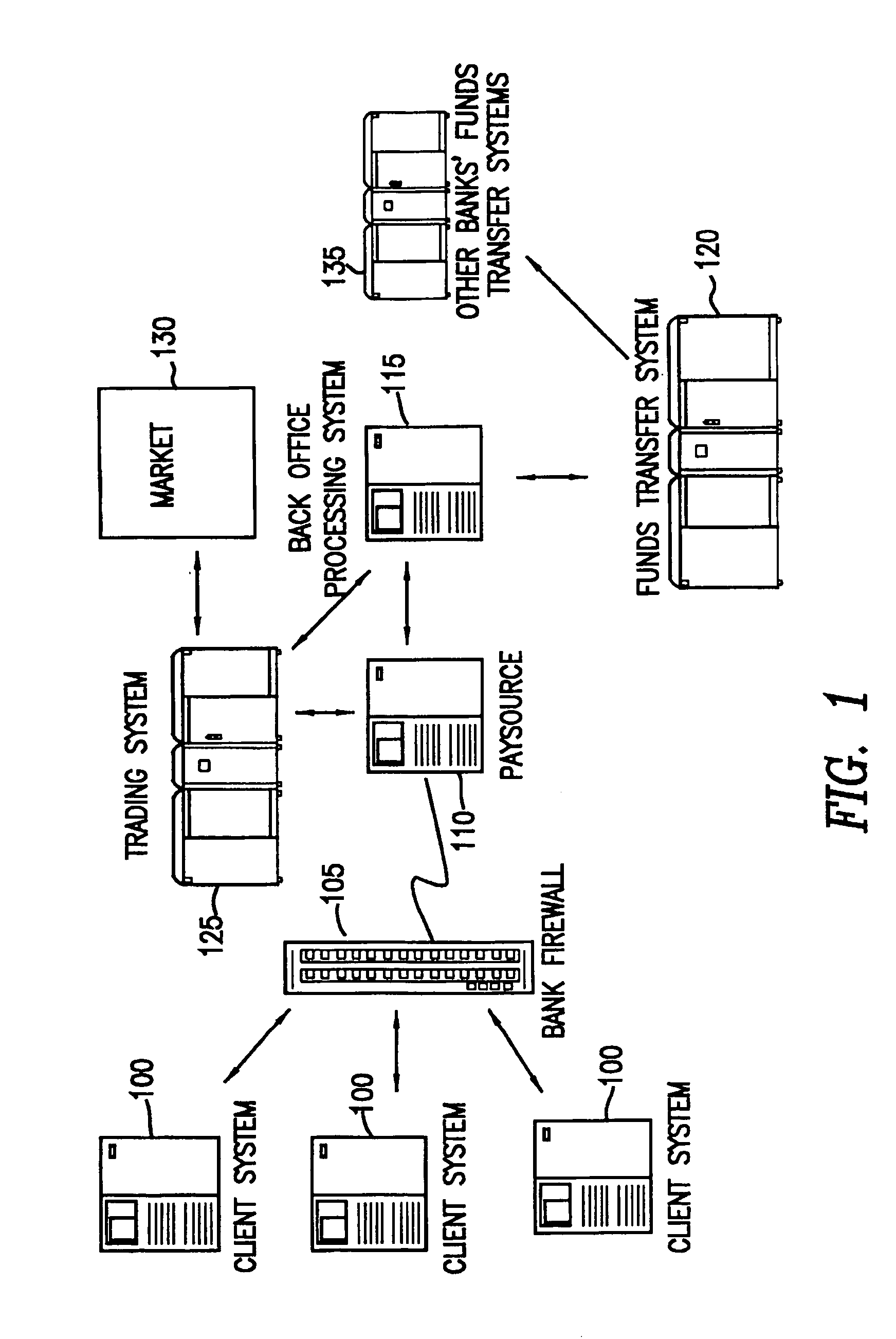

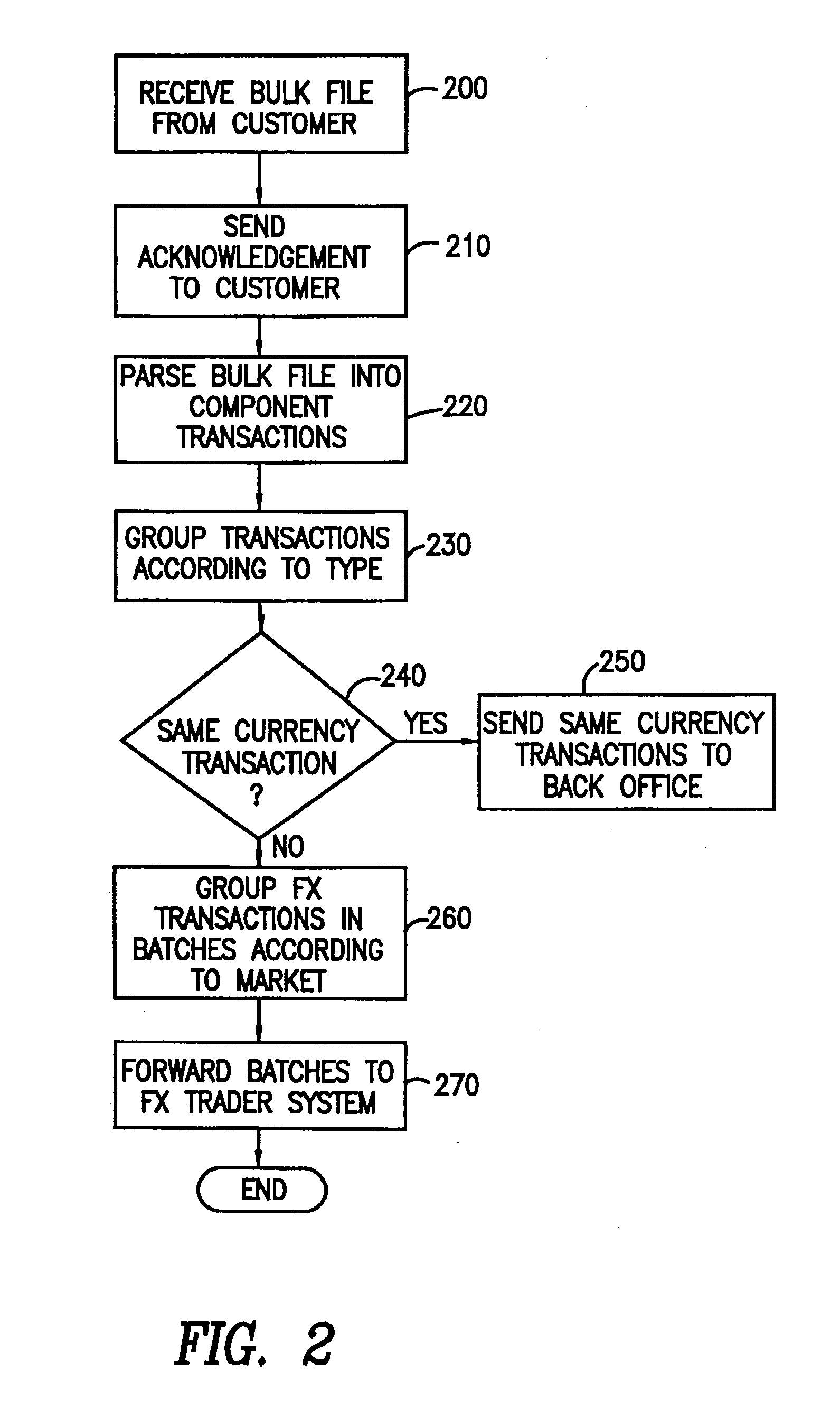

System and method for processing foreign currency payment instructions contained in bulk files

A system an method allowing customers of a banking institution to transmit bulk files of payment instructions to the bank for execution. The payment instructions may include a mix of domestic or international Automated Clearing House (ACH) transactions, domestic or international wire transfers, multibank transactions and instructions to print checks drawn on the receiving bank or at another bank. For payments requiring payment in a foreign currency in which the customer does not have an account the present invention automatically generates and executes a contract for the foreign exchange (FX) to obtain the currency required to fulfill the payment instruction. The automatic FX process can furthermore use a real time feed of foreign exchange rates as opposed to the static rates traditionally applied to such contracts.

Owner:JPMORGAN CHASE BANK NA

Method and system for multi-currency escrow service for web-based transactions

ActiveUS7464057B2Lower capability requirementsLimited accessFinanceCurrency conversionCredit cardDirect debit

A method and system for escrow service for web-based transactions is web-accessible and accepts registrations from exchanges and / or portal partners. The completion of registration and transactions is allowed to entitled users who access the system via the web. The system maintains an internal banking engine to act as a deal manager, messaging service and accounts sub-ledger and escrows funds entrusted to it. The transaction process is composed of a number of transaction statuses, and reporting of those statuses to users is accomplished online and via web query. The system supports several methods of payment, such as credit cards, authorized Automated Clearing House (ACH) or equivalent direct debit / credit and wire transfer payments, and all funds movements are electronic. The system supports transaction level detail through its banking engine accounts; funds movements from its currency accounts, and escrows funds to currency based escrow accounts. Buyers completing goods / services inspections after delivery initiate settlements.

Owner:CITIBANK

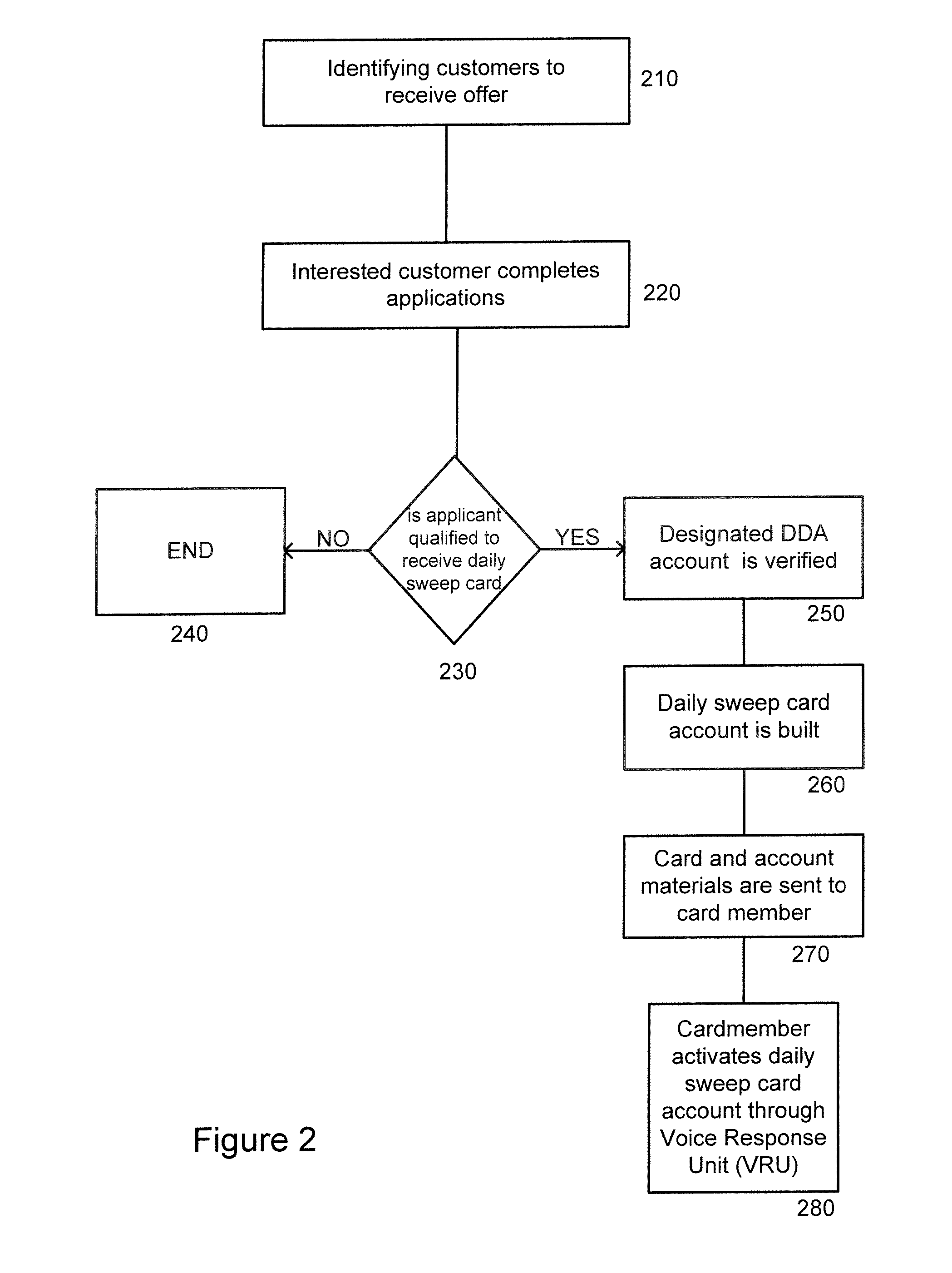

System and method for linked account having sweep feature

A computer-implemented method for facilitating electronic funds transactions is disclosed. According to one embodiment, the method may comprise the steps of: issuing a transaction card to a cardholder by associating the transaction card with a demand deposit account from which the cardholder is authorized to electronically disburse funds; receiving an authorization request for an attempted transaction between a merchant and the cardholder, the authorization request containing information associated with the transaction card and the attempted transaction; processing the authorization request based on one or more predetermined business rules; authorizing the transaction without immediately settling the transaction against the demand deposit account of the cardholder; and settling the transaction, at a time subsequent to the execution of the transaction, through automated clearing house (ACH) from funds retained within the demand deposit account of the cardholder.

Owner:JPMORGAN CHASE BANK NA

Automated clearing house compatible loadable debit card system and method

Owner:WOW TECH CORP

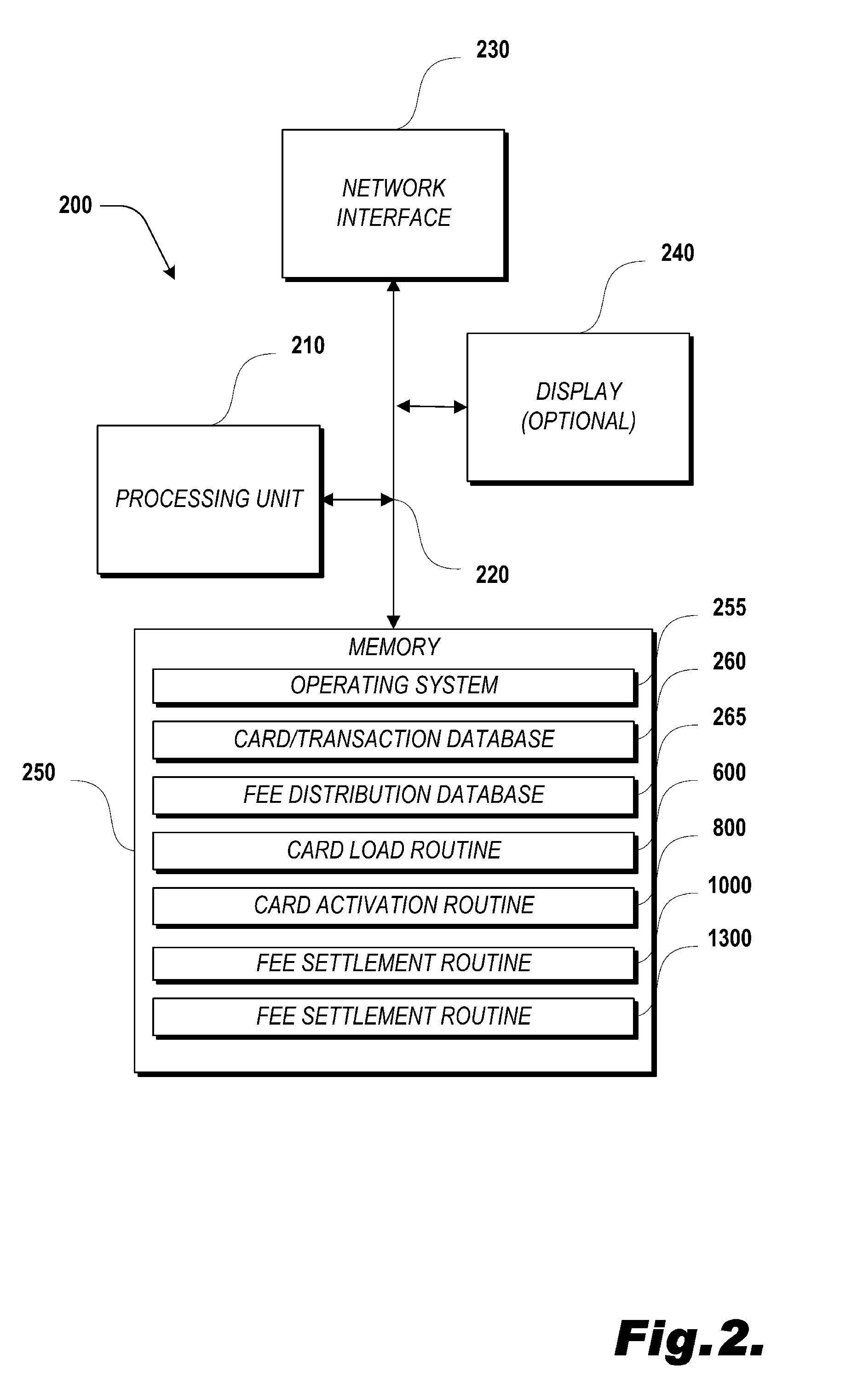

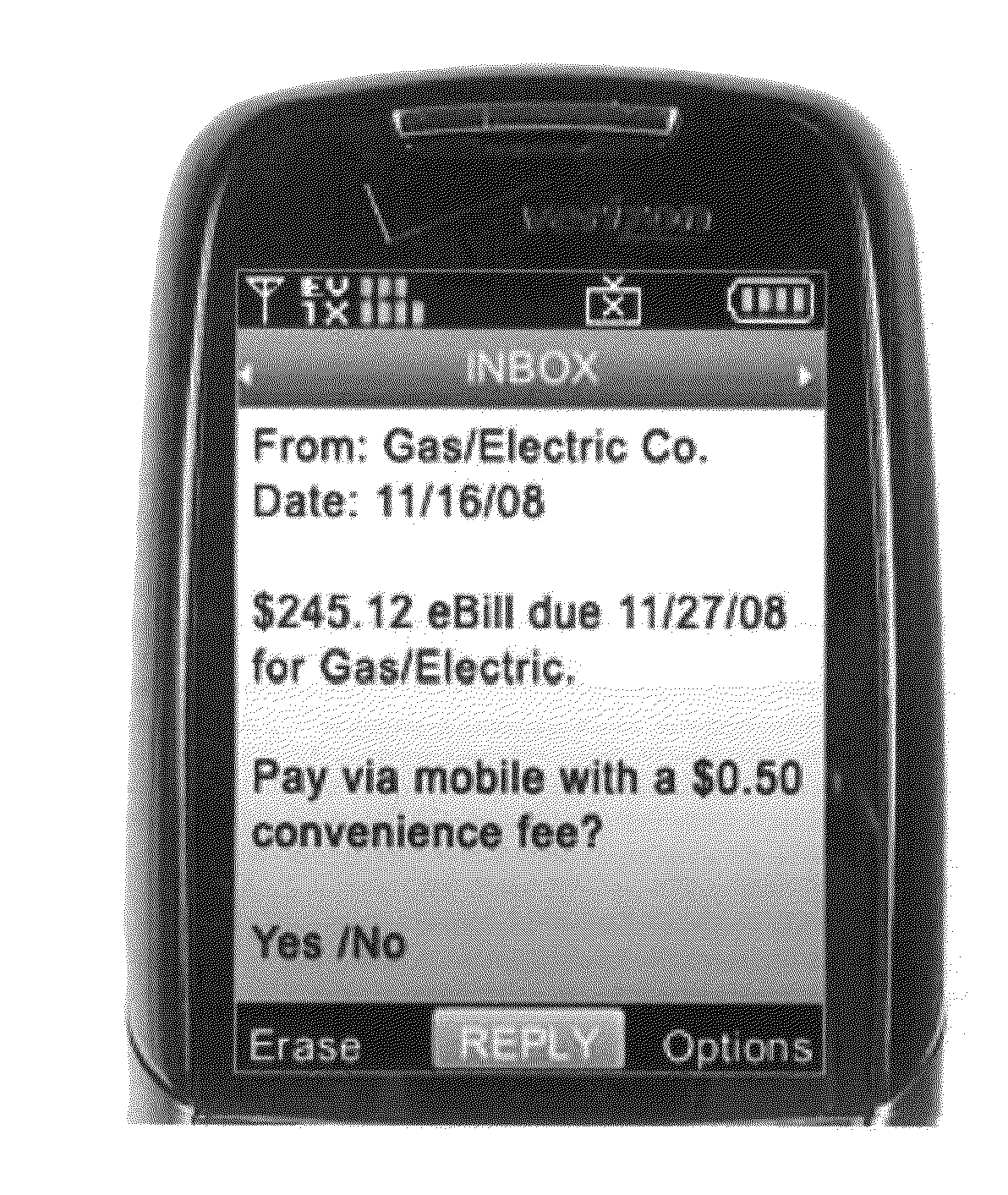

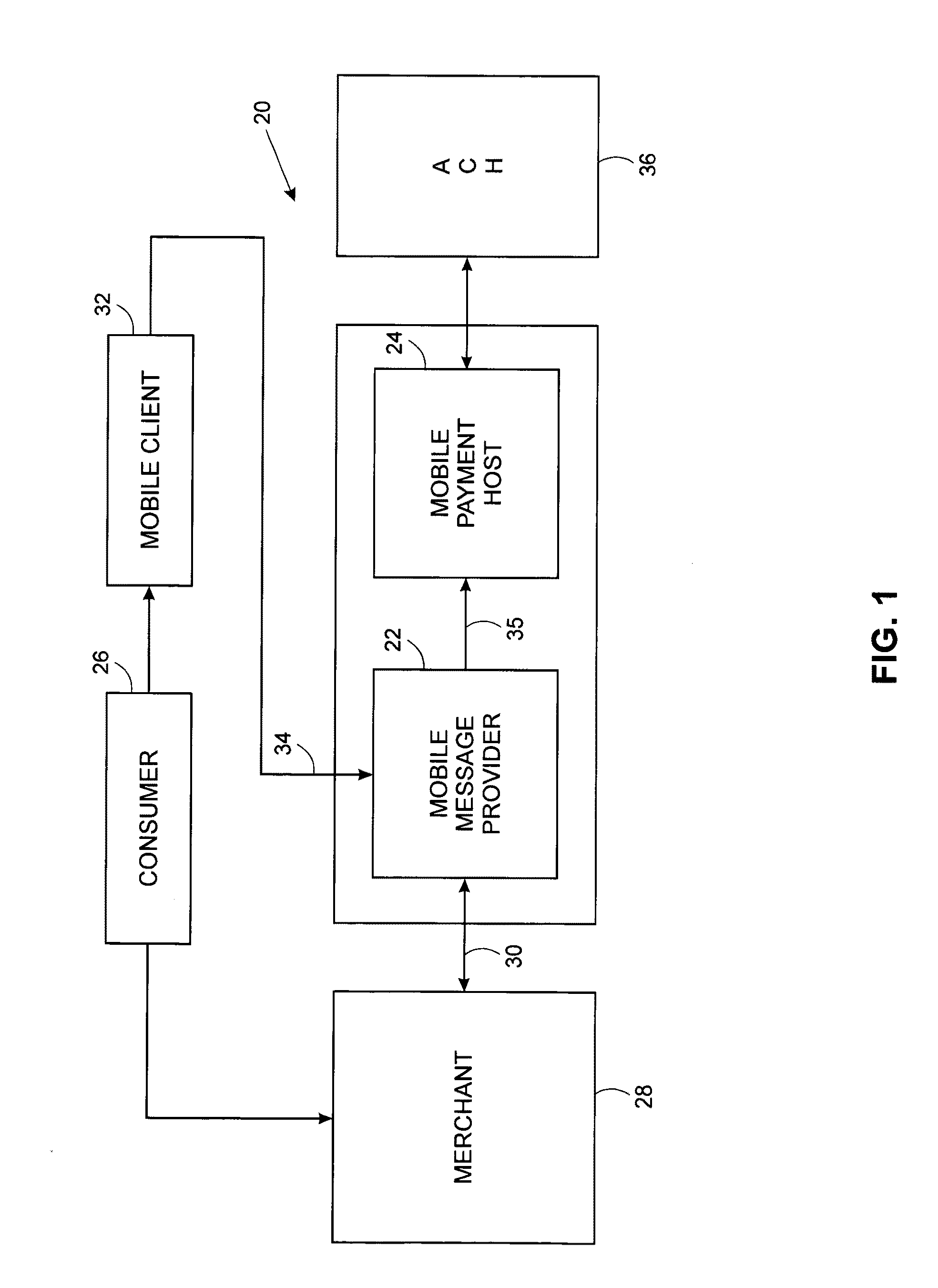

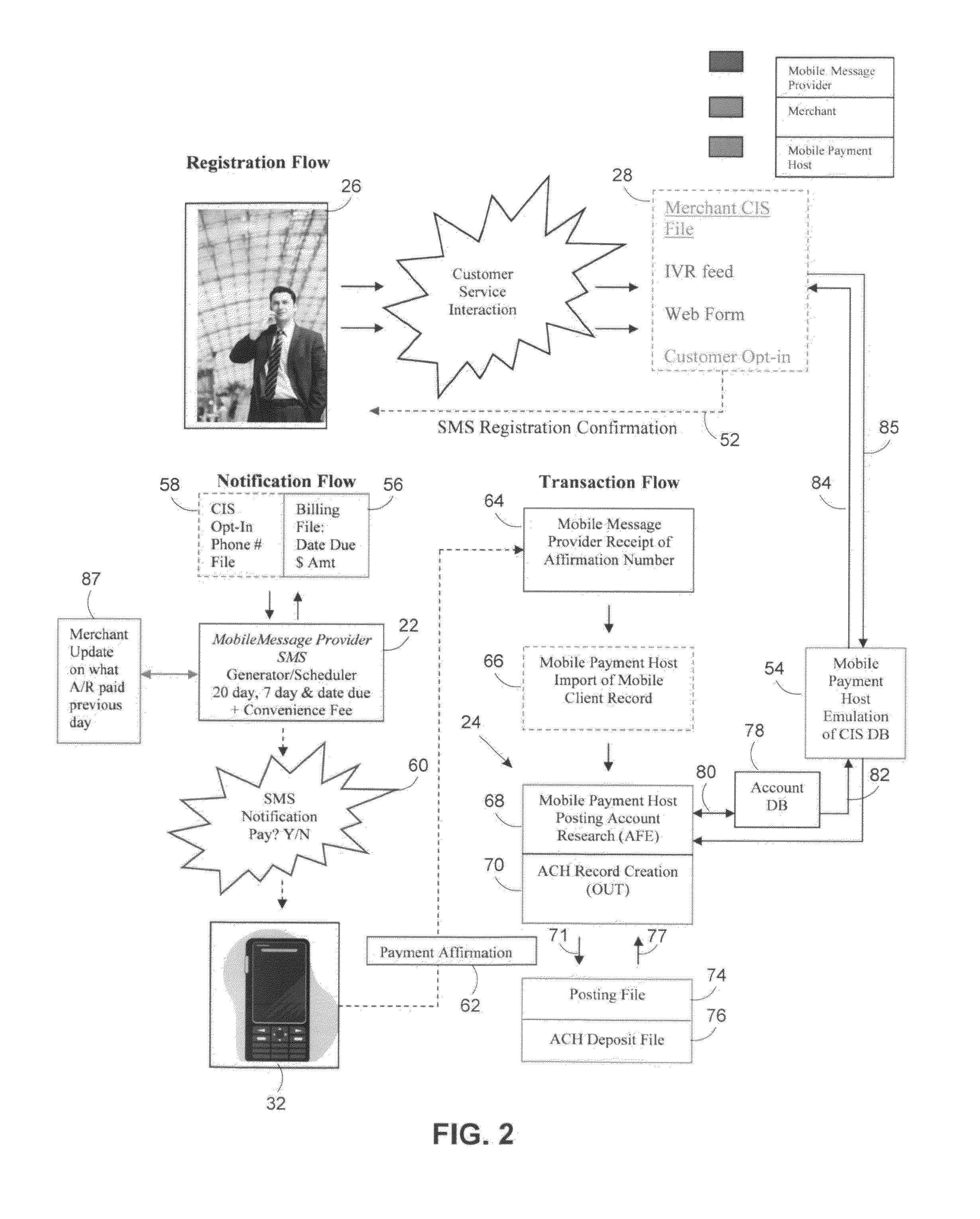

Mobile payment system

InactiveUS20110022515A1Reduces “ float time ”Short timeAccounting/billing servicesFinanceTelecommunicationsClient-side

A mobile payment system is disclosed for processing payments authorized by mobile devices (“mobile payments”) that is configured to process mobile payment authorizations that are directed to an electronic lock box. The mobile payment authorizations are processed by way of electronic funds transfer and cleared, for example, by way of an automated electronic funds clearing network, such as the Automated Clearing House (ACH). In accordance with an important aspect of the invention, the mobile payment system also processes returns for payments that cannot be cleared. The mobile payment system may be configured to provide advance notification of billing deadlines to payees, e.g., mobile clients, by way of an SMS (Small Message System) message and enable consumers to authorize payment in the same fashion. In addition to facilitating payment by the consumer, the system in accordance with the present invention significantly the “float time” and makes funds available to the merchant in a relatively shorter period of time than known mobile payment systems, once payment authorization is received from the consumer.

Owner:WAUSAU FINANCIAL SYST

Method and system for extending credit with automated repayment

A system and method for extending a firm offer of credit contingent upon receiving a one-time authorization to execute recurring automatic withdrawals from a deposit account is provided. In providing the one-time authorization to execute recurring automatic withdrawals, a prospective borrower may elect from a plurality of automatic withdrawal repayment options. One such option is electronic fund transfer, such as the initiation of a withdrawal entry into the Automated Clearing House network. A second option is by the remote creation of a paper negotiable instrument, which is then converted into an electronic substitute check capable of electronic routing. Upon receiving the one-time authorization, the lender may make recurring automatic withdrawals from the borrower's deposit account.

Owner:CC SERVE

Searching for and identifying automated clearing house transactions by transaction type

Identifying automated clearing house (“ACH”) transaction items processed by an ACH operator comprises processing ACH items for acceptance by the ACH operator. Each ACH item relates to an ACH transaction type. Each ACH item is associated with a corresponding ACH transaction type to which it is related. Each ACH item also is associated with parties involved in the transaction detailed in the ACH item. A request for information regarding a specified ACH transaction type is received from a requesting party. ACH items associated with the specified ACH transaction type and the requesting party are identified in response to receiving the request. Information regarding the identified ACH items is presented to the requesting customer.

Owner:US FEDERAL RESERVE BANK OF MINNEAPOLIS +1

Value tracking and reporting of automated clearing house transactions

Value tracking of automated clearing house (“ACH”) payments processed by an ACH operator includes receiving an ACH file for ACH processing. The ACH file comprises ACH payments originated by a remote sending point on behalf of a sending customer. A sum value of the ACH payments is added to a value of prior payments processed for the sending customer during a specified time period to obtain an accumulated payment value. The accumulated payment value is compared to a pre-established payment cap to determine whether the accumulated payment value exceeds the payment cap. The ACH payments are processed in response to a determination that the accumulated payment value does not exceed the payment cap. Whether to override the payment cap can be determined in response to a determination that the accumulated payment value exceeds the payment cap.

Owner:US FEDERAL RESERVE BANK OF ATLANTA

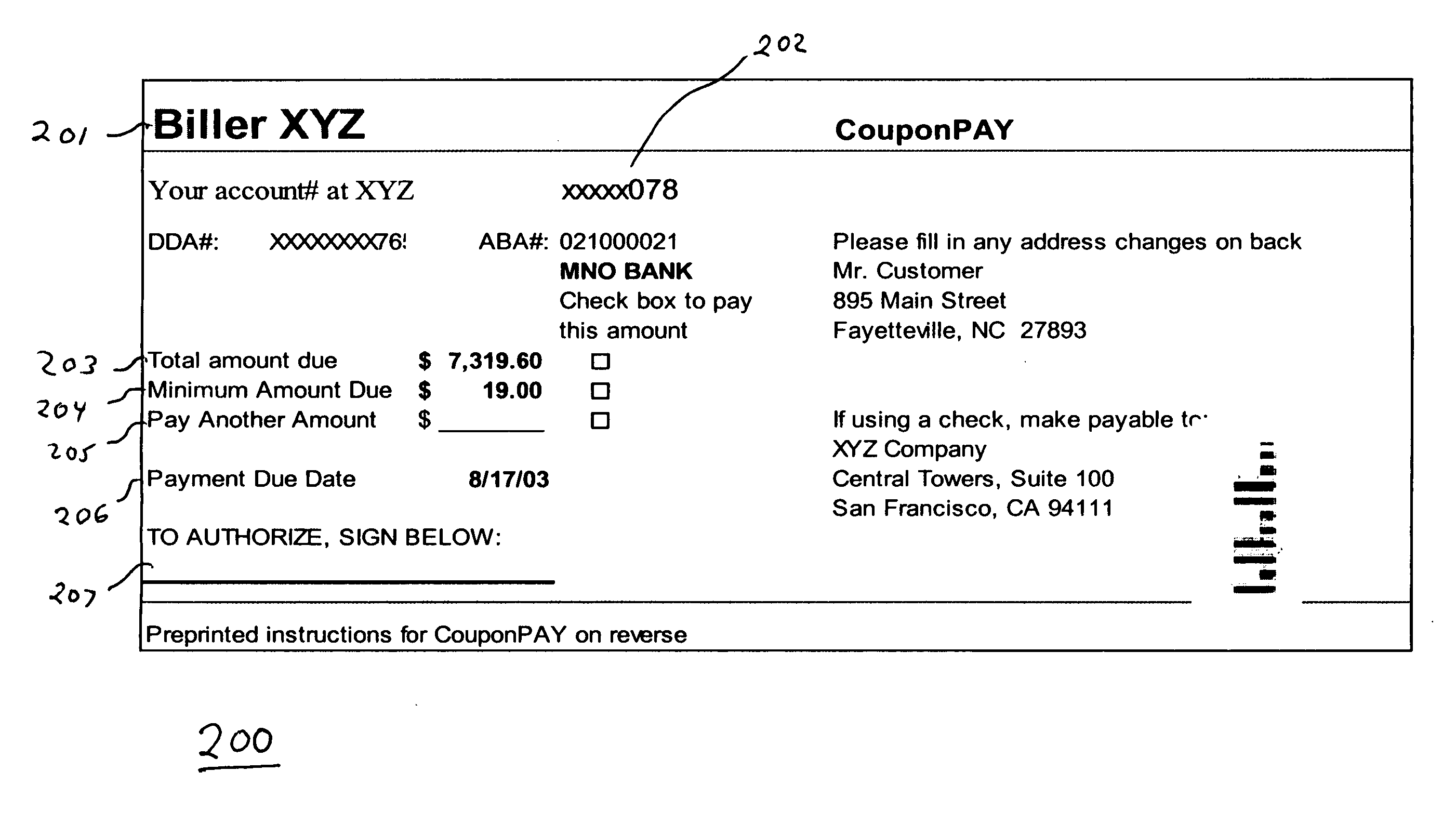

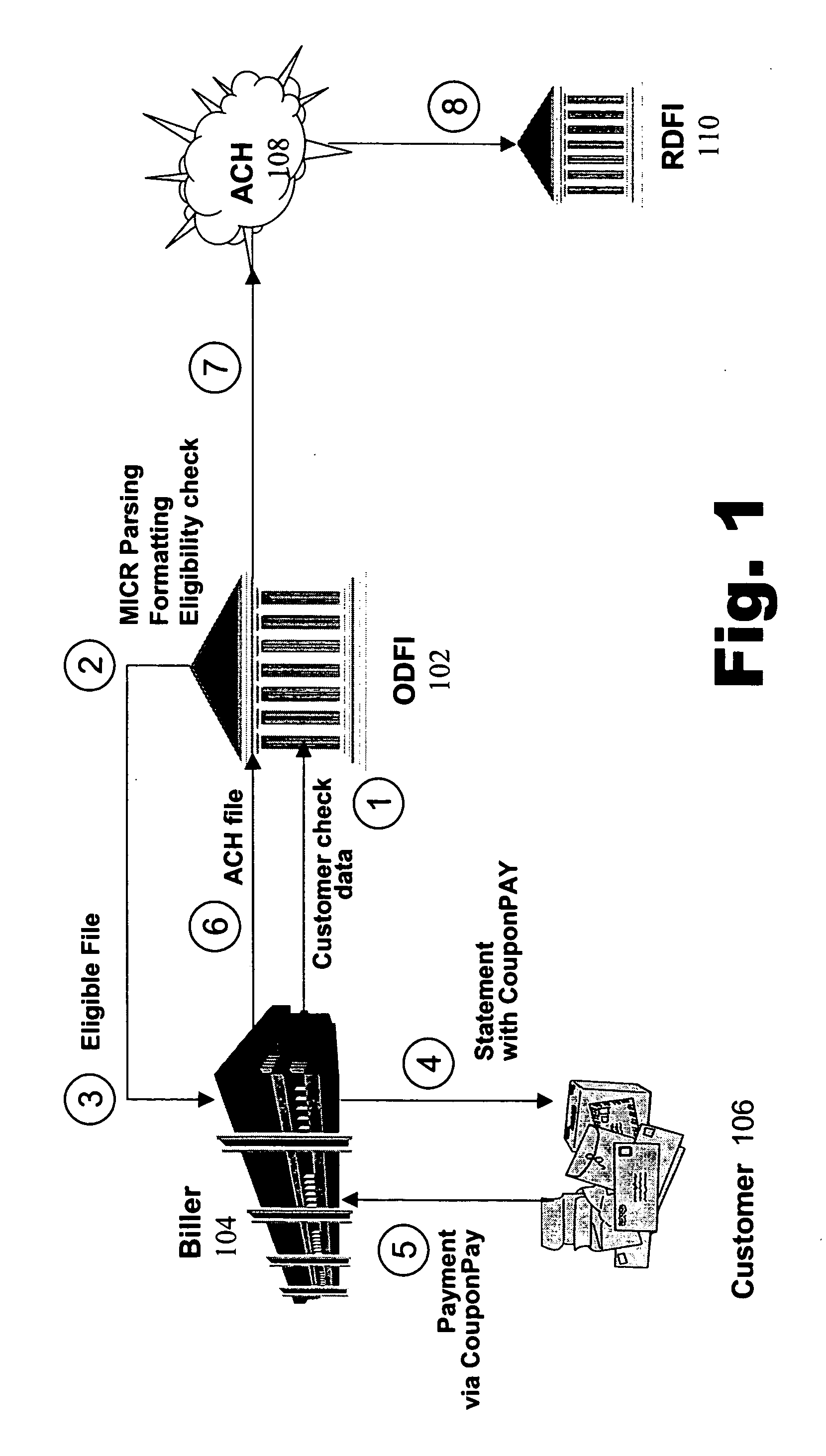

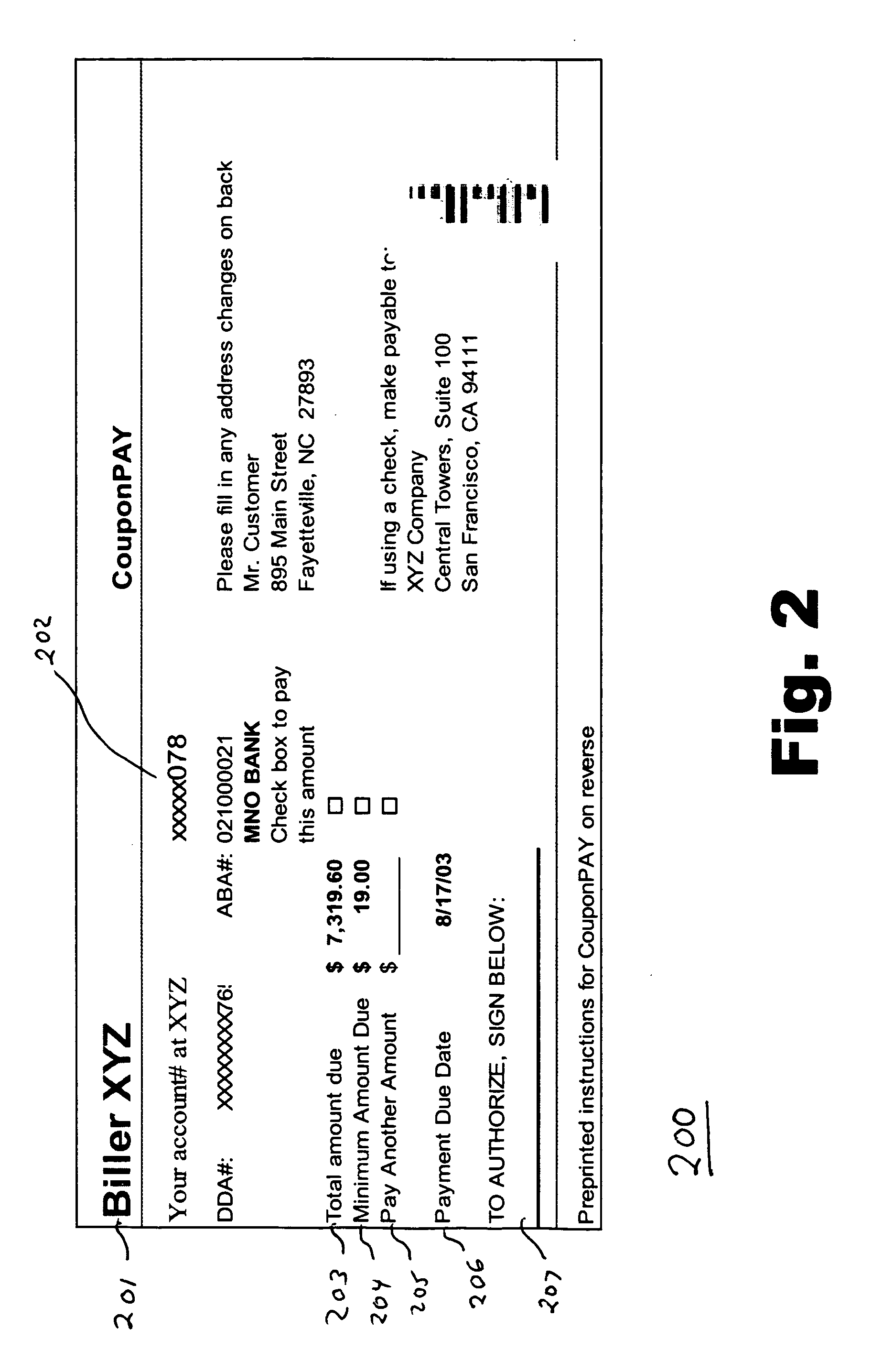

Coupon payment system

As an alternative to bill payments made with paper checks, customers are provided with “Sign-to-Pay” payment coupons along with their bills. A customer elects to pay the bill either by check or by returning the “Sign-to-Pay” payment coupon. The coupon will not contain the customer's checking account information. However, the payment amount indicated on the coupon will subsequently be deducted from the customer's checking account. Preferably, bill payments will be made through the Automated Clearing House (ACH) network which is an efficient and less expensive alternative to the traditional check clearing process.

Owner:JPMORGAN CHASE BANK NA

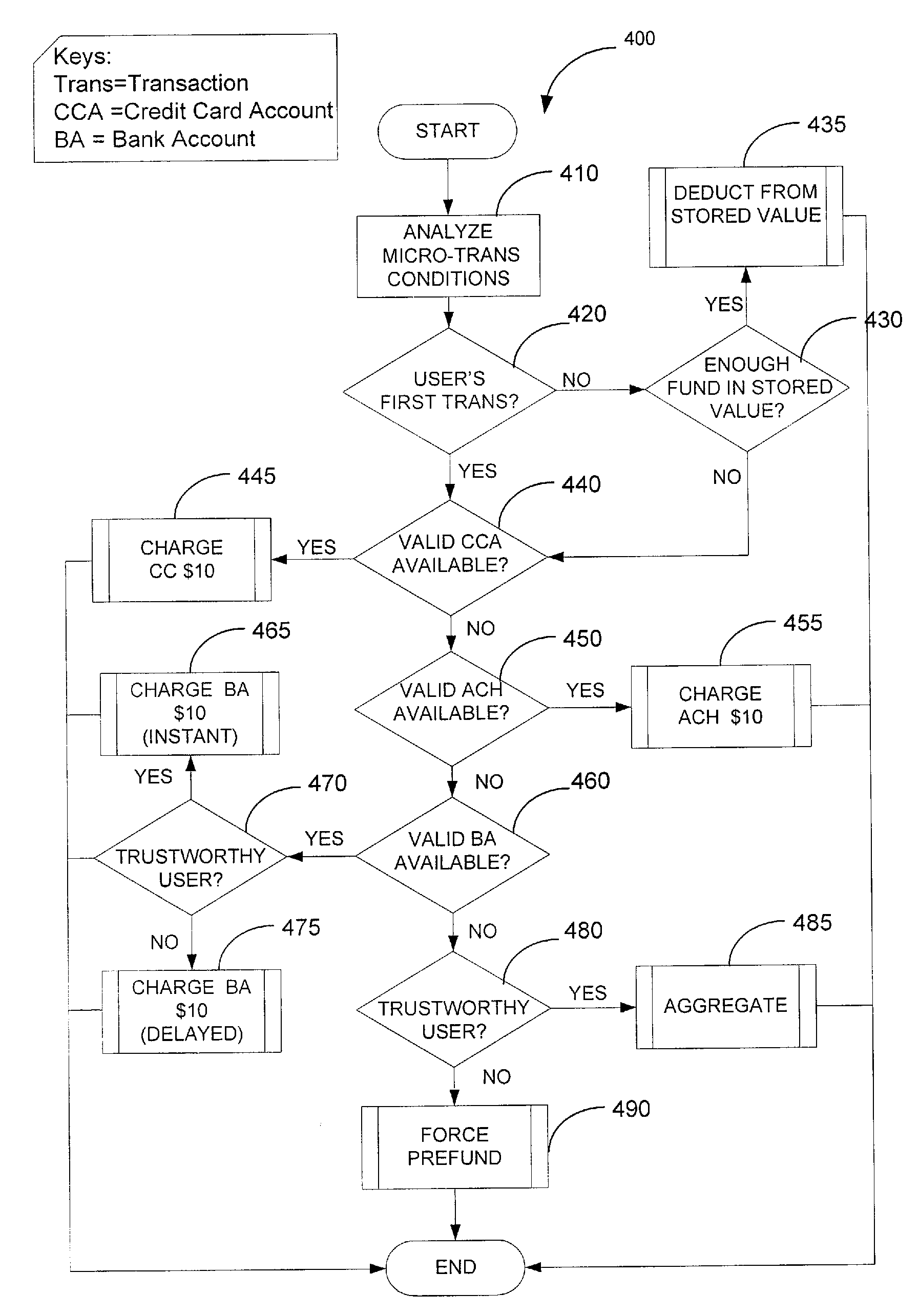

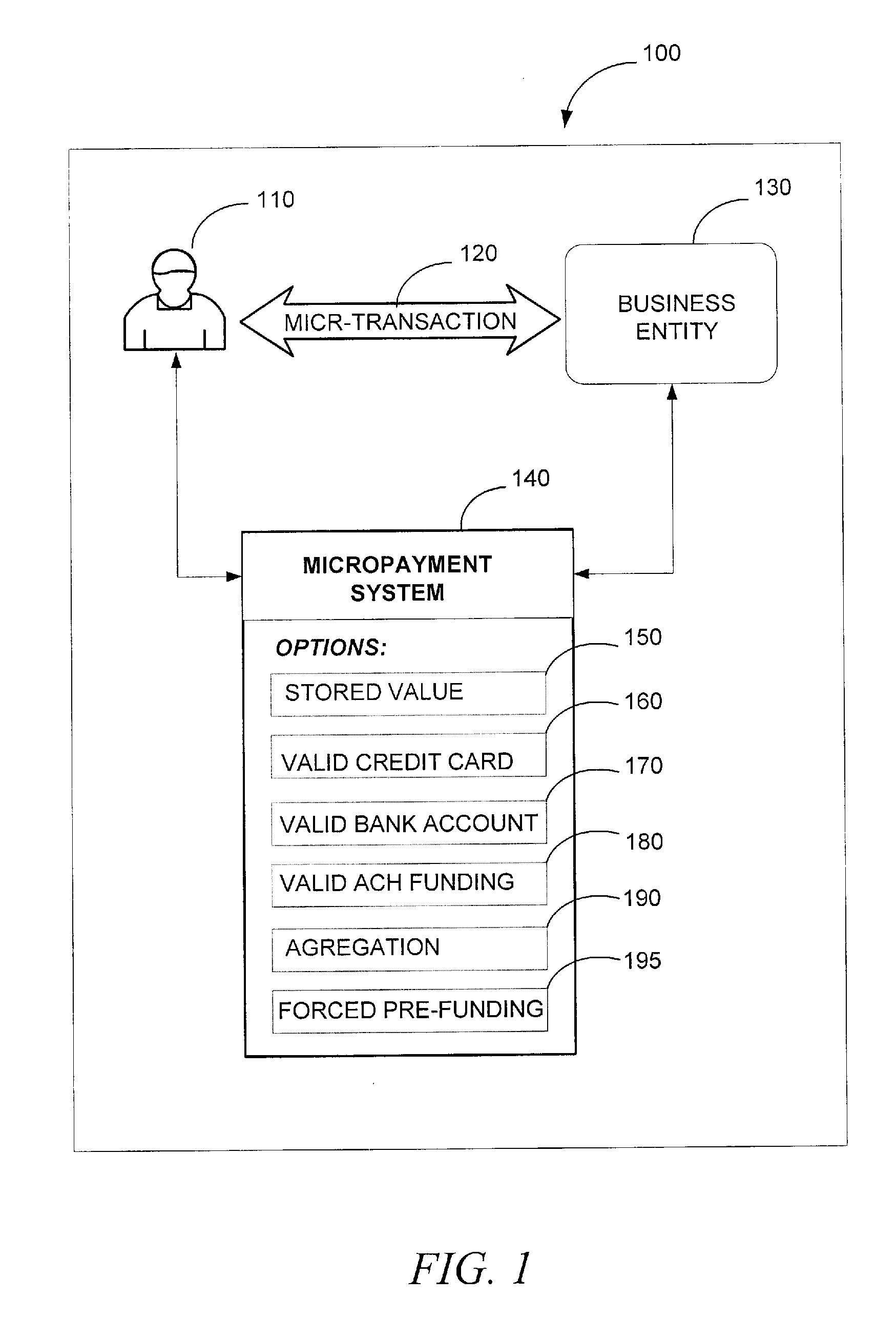

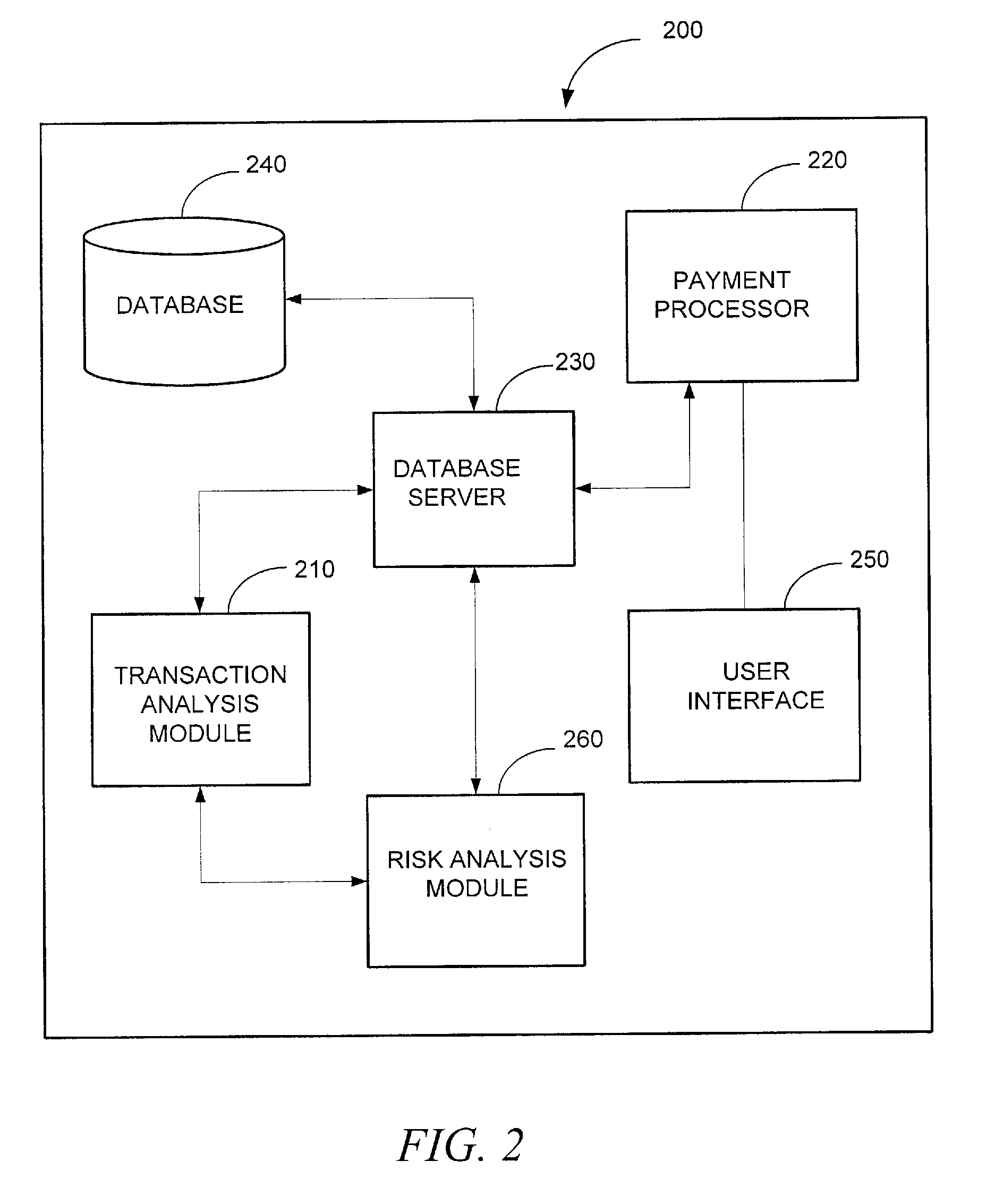

Ach-enabled micropayments

A method and a system for arranging for micropayment of transaction amounts related to micro-transactions transacted by a user are provided. In example embodiments, the method may include analyzing transaction conditions (e.g., availability of a stored value, a valid bank account, an Automated Clearing House (ACH) funding, a credit card account, or a transaction risk assessment result, associated with the user, and monetary value of the micro-transaction) and selecting a micropayment option for charging the transaction amount from a group of micropayment options, based on the transaction condition. The method may also include automatically applying the selected micropayment option for charging the transaction amount. According to example embodiments, the system may include a transaction analysis module and a payment processor.

Owner:PAYPAL INC

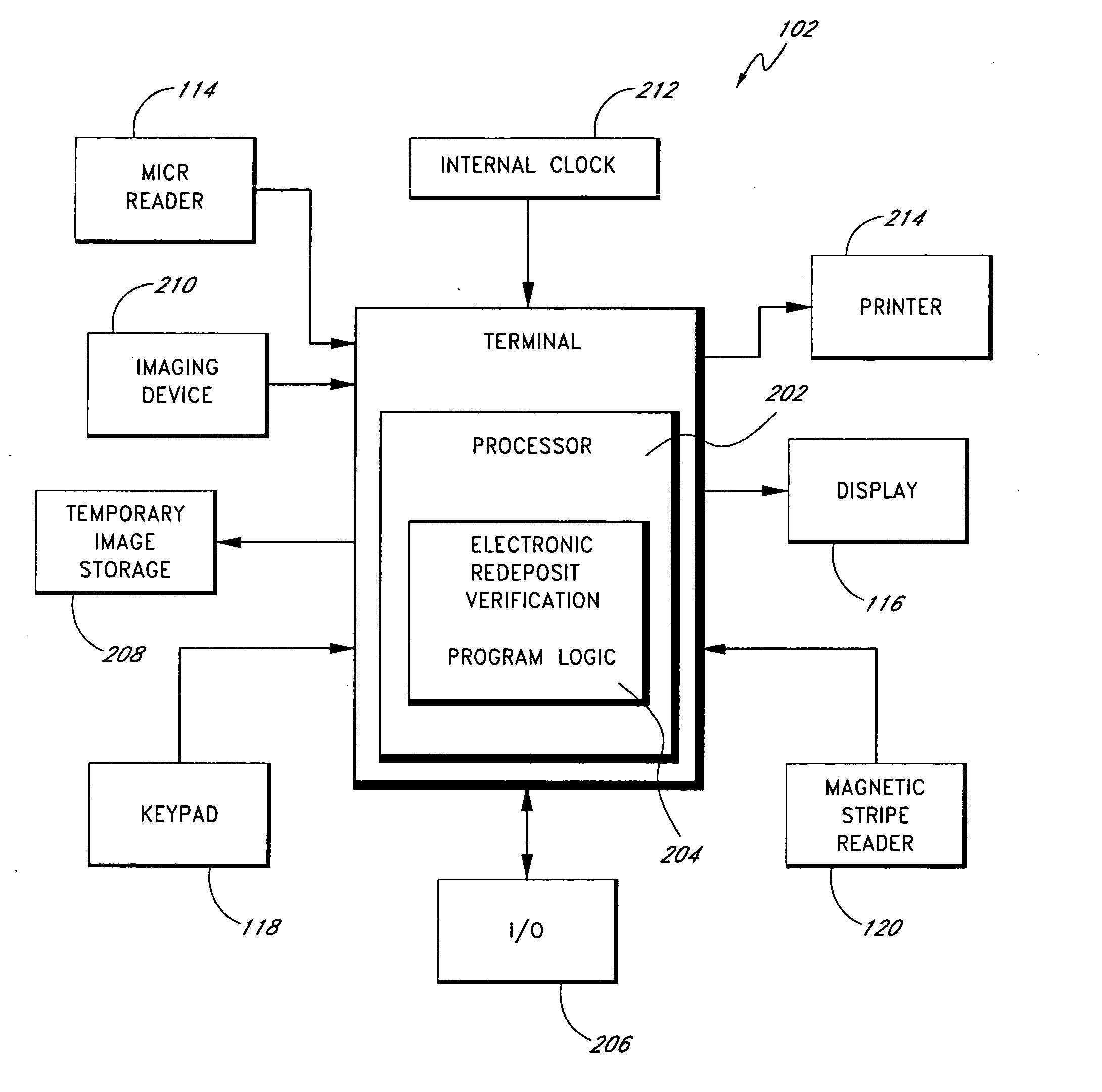

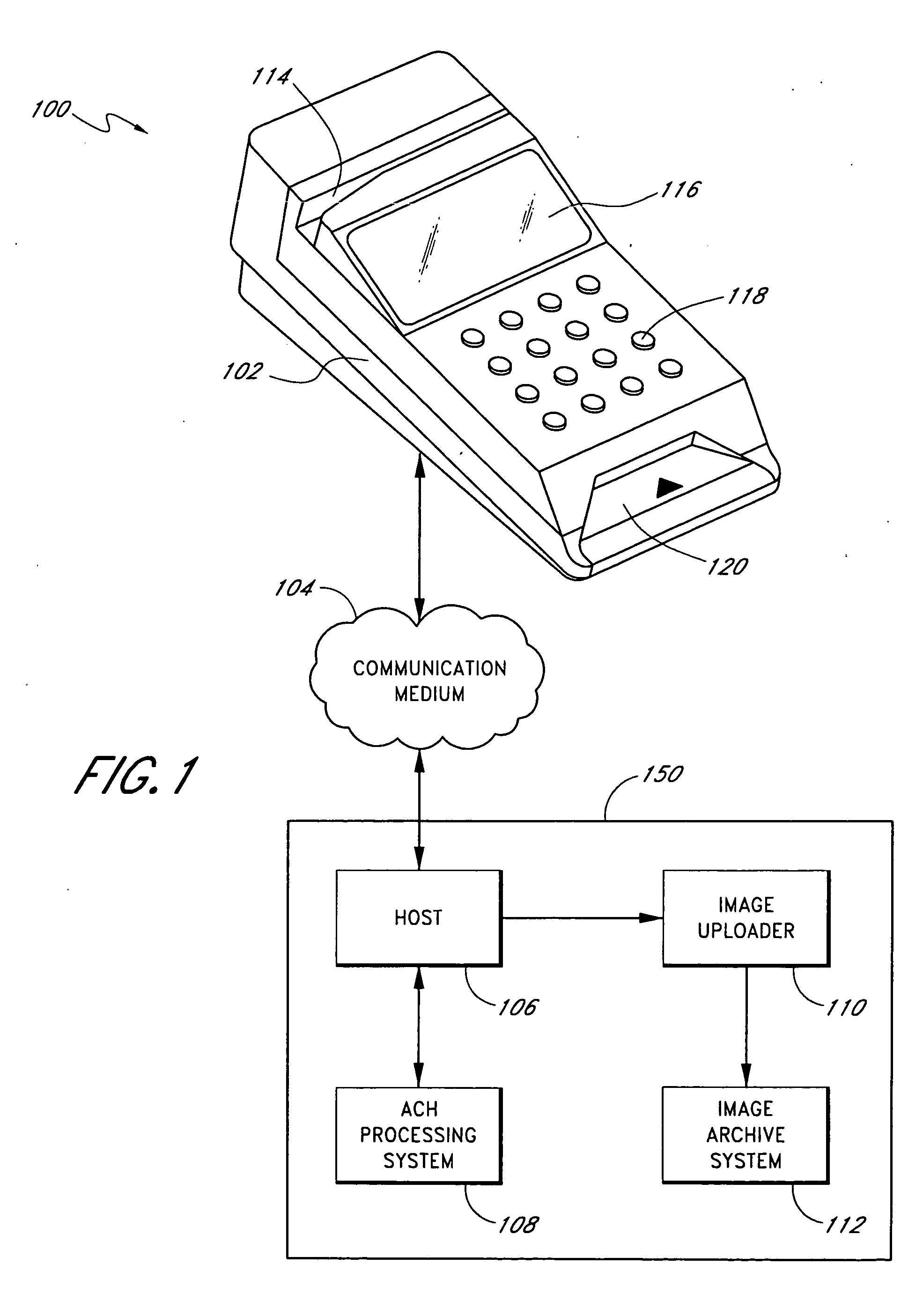

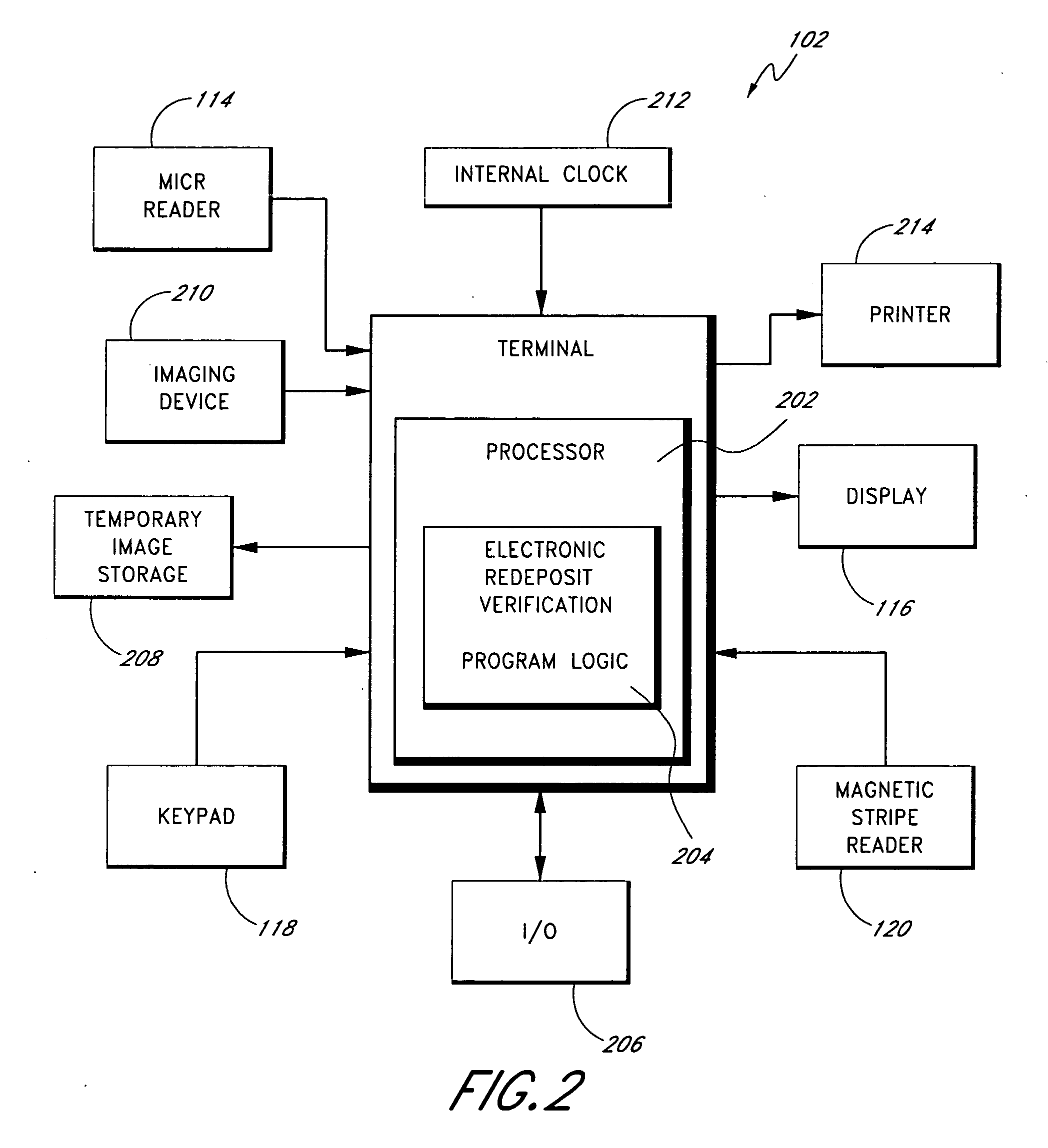

Apparatus and method for amount verification of paper checks for electronic redeposit

InactiveUS20050137979A1Increases possible collectionIncrease probabilityFinanceCash registersEngineeringCheque

A verification system for electronic redeposit of paper checks determines with a merchant terminal whether a paper check meets criteria for electronic redeposit. In an embodiment of the invention, the electronic redeposit verification system verifies with a terminal that the amount of the check is less than a predetermined threshold. In a further embodiment of the invention, the National Automated Clearing House Association (NACHA) establishes the criteria.

Owner:FIRST DATA

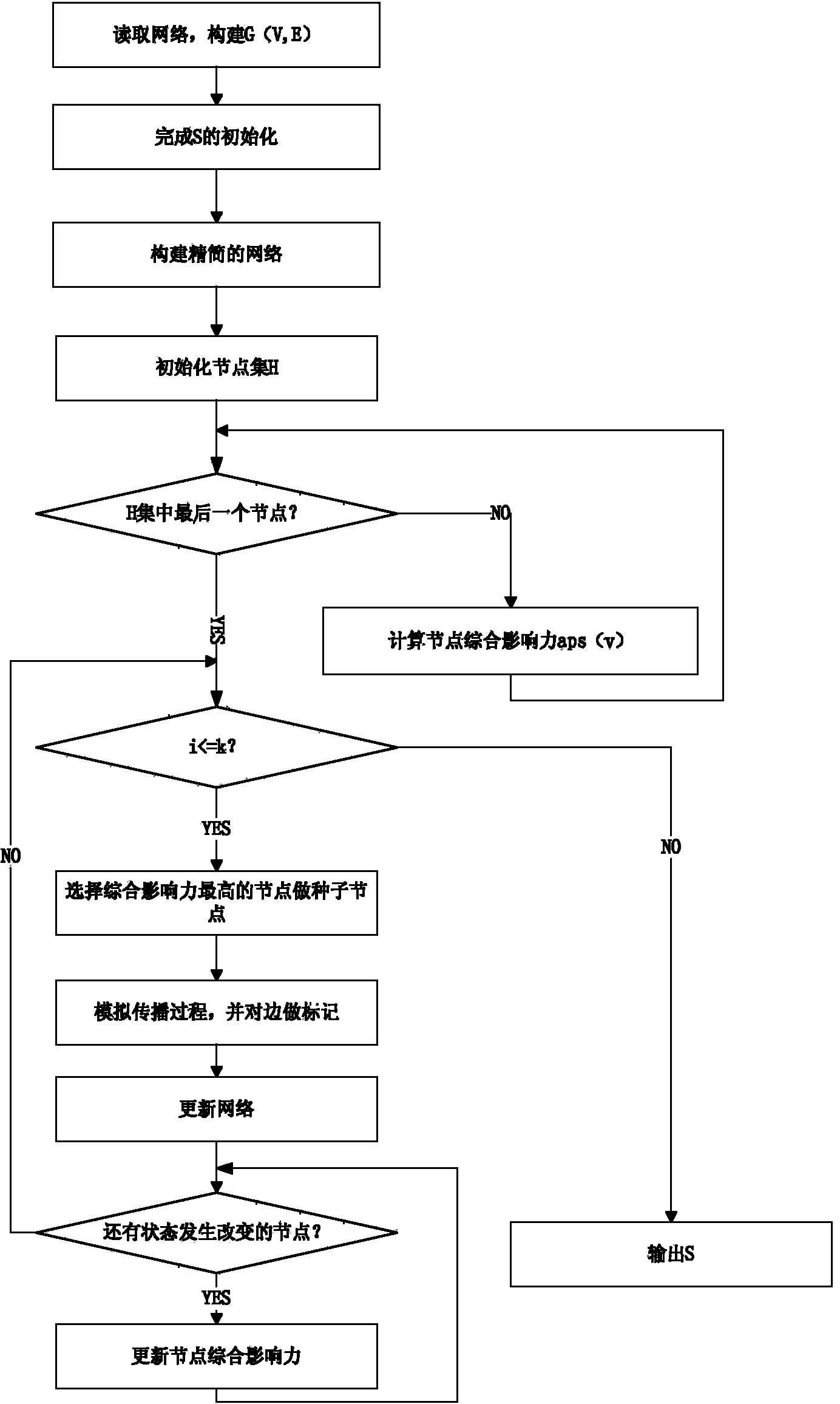

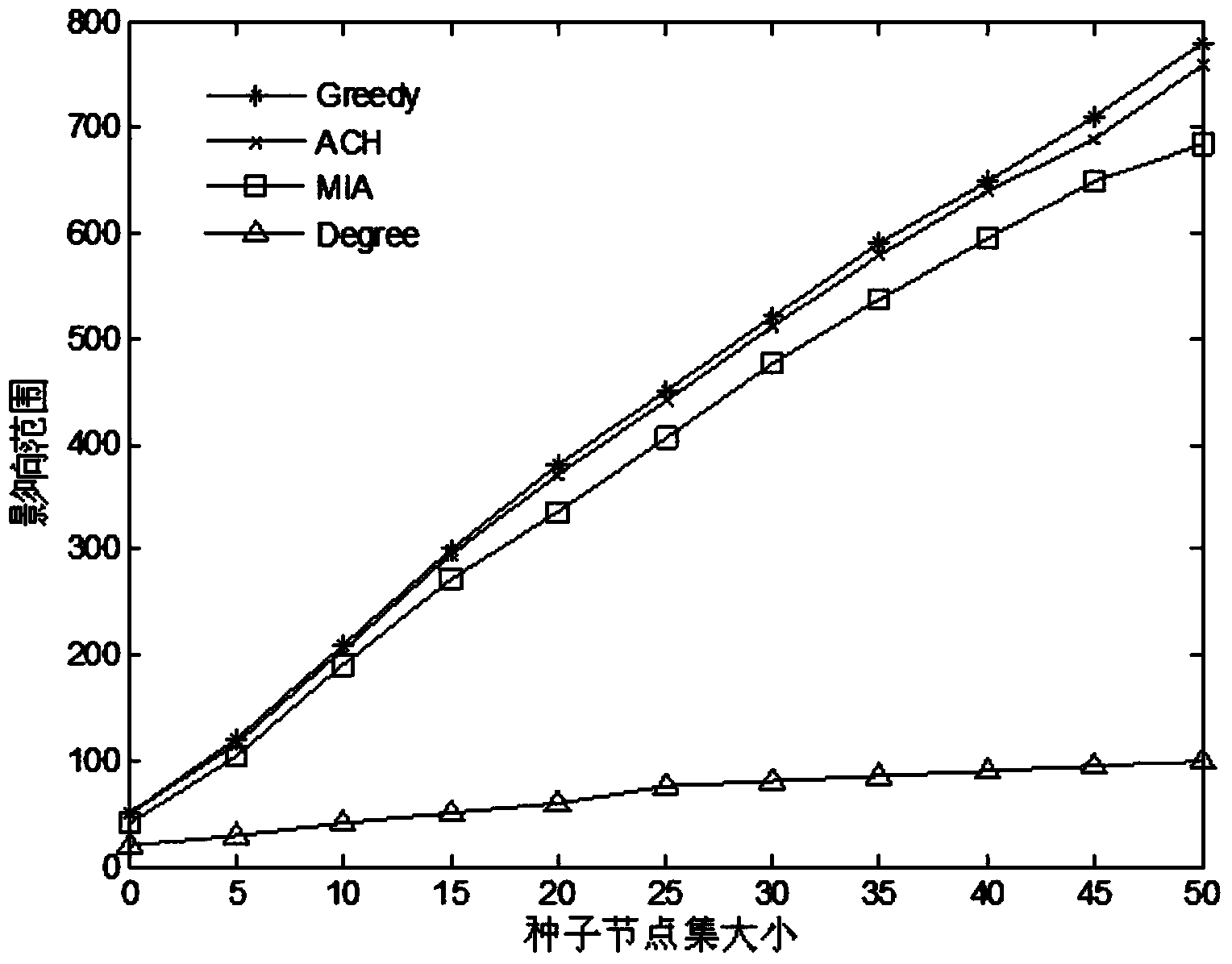

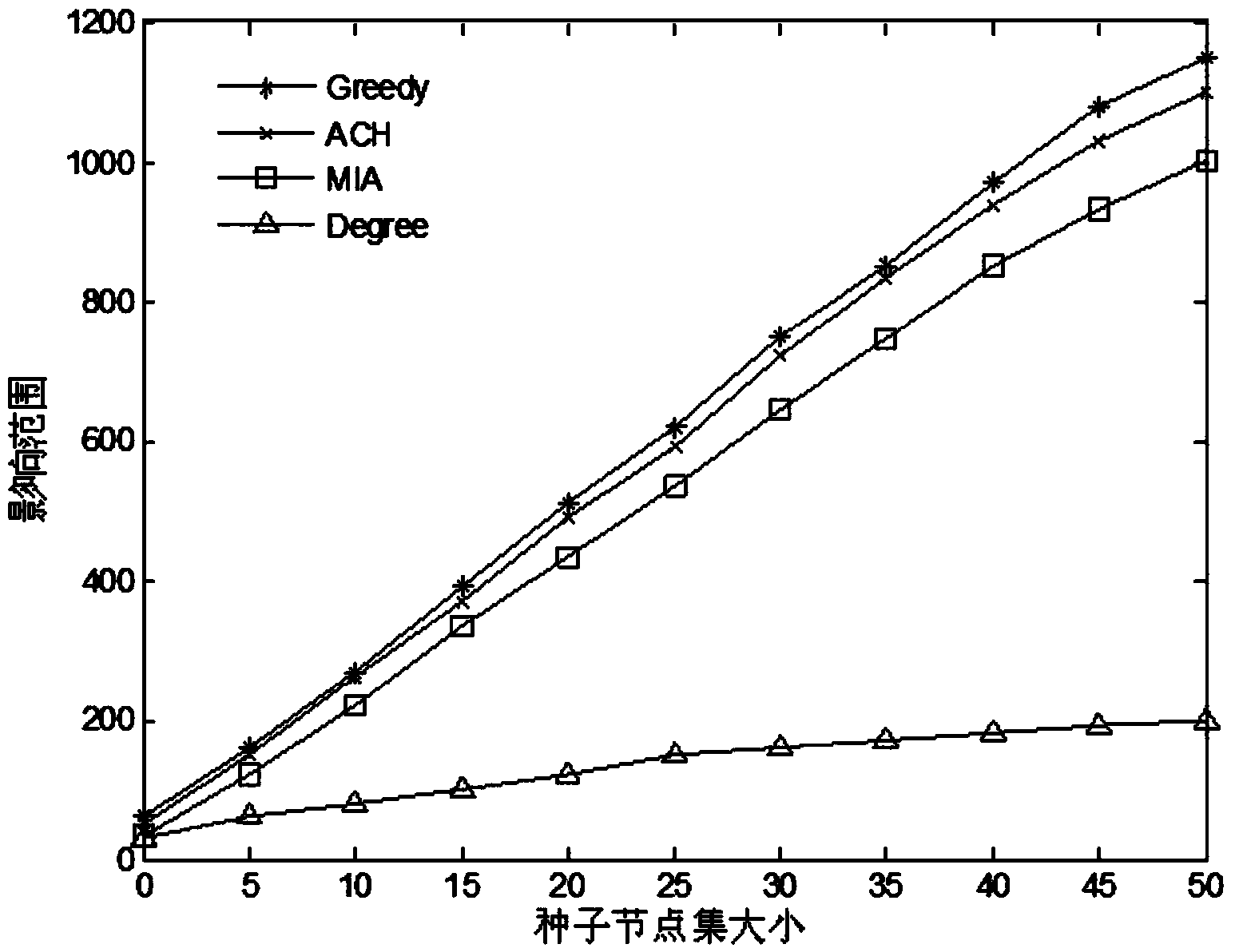

Social network influence maximization method based on activeness

InactiveCN104050245AScience of Impact Maximization ProblemsImprove timelinessData processing applicationsSpecial data processing applicationsGreedy algorithmSocial web

The invention discloses a social network influence maximization method based on activeness. The social network influence maximization method comprises the following steps: constructing a simple network G'; selecting a node with a high activeness ACT attribute value according to a node activeness ACT attribute to enter an ACT node set H; calculating a node influence synthetic value aps (v) according to the sizes of the node activeness ACT attribute value and the influence; circularly selecting k seed nodes; updating the node influence synthetic value aps (v) in a network when each seed node is selected. A result shows that the activeness attribute is introduced based on an IC model; the extension of the model enables a social network influence maximization problem to be more scientific; an ACH (Automated Clearing House) algorithm is close to an influence range of a KK greedy algorithm in an influence range and the social network influence maximization method has very good representation on timeliness.

Owner:JIANGSU UNIV

Non-cash transaction incentive and commission distribution system

An electronic fund transfer system is disclosed wherein commissions for point-of-sale purchase transactions are determined and distributed to members of an organizational network for promoting use of a non-cash payment device that is tangible for effecting purchase transactions. Purchase data is electronically transmitted from the point-of-sale to an automated clearing house for effecting fund transfers to prepare the purchase, and also to a commission management system. The commission management system maintains an electronic database reflecting the structure of the organizational network, and further determines the distribution of purchase commissions according to a predetermined schedule of proportions relating to the position and business volume of each member of the network. The commission management system further comprises a payment processor for effecting commission payments to the members or to a designated sponsor on a scheduled basis.

Owner:MASI LARRY A

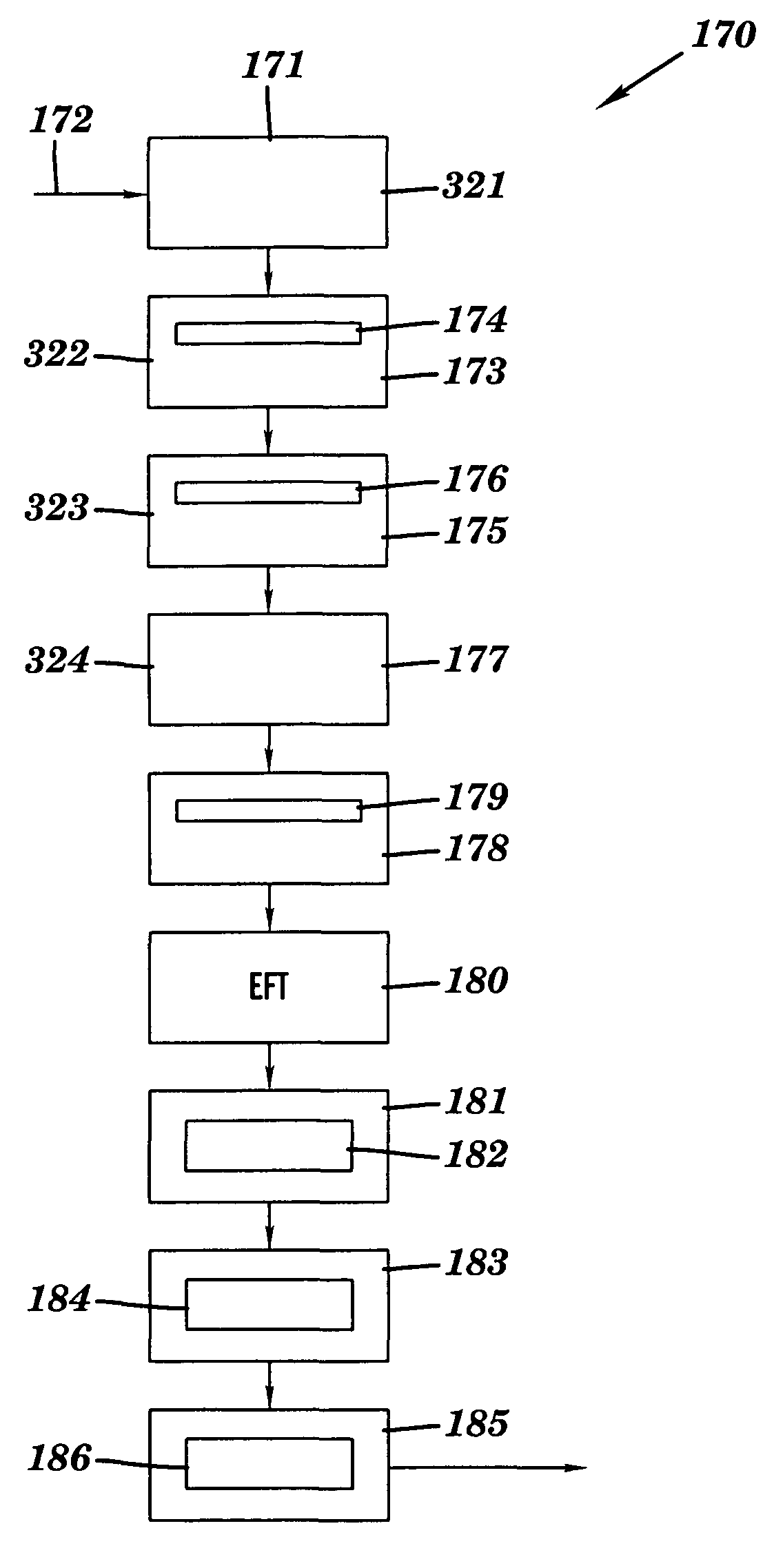

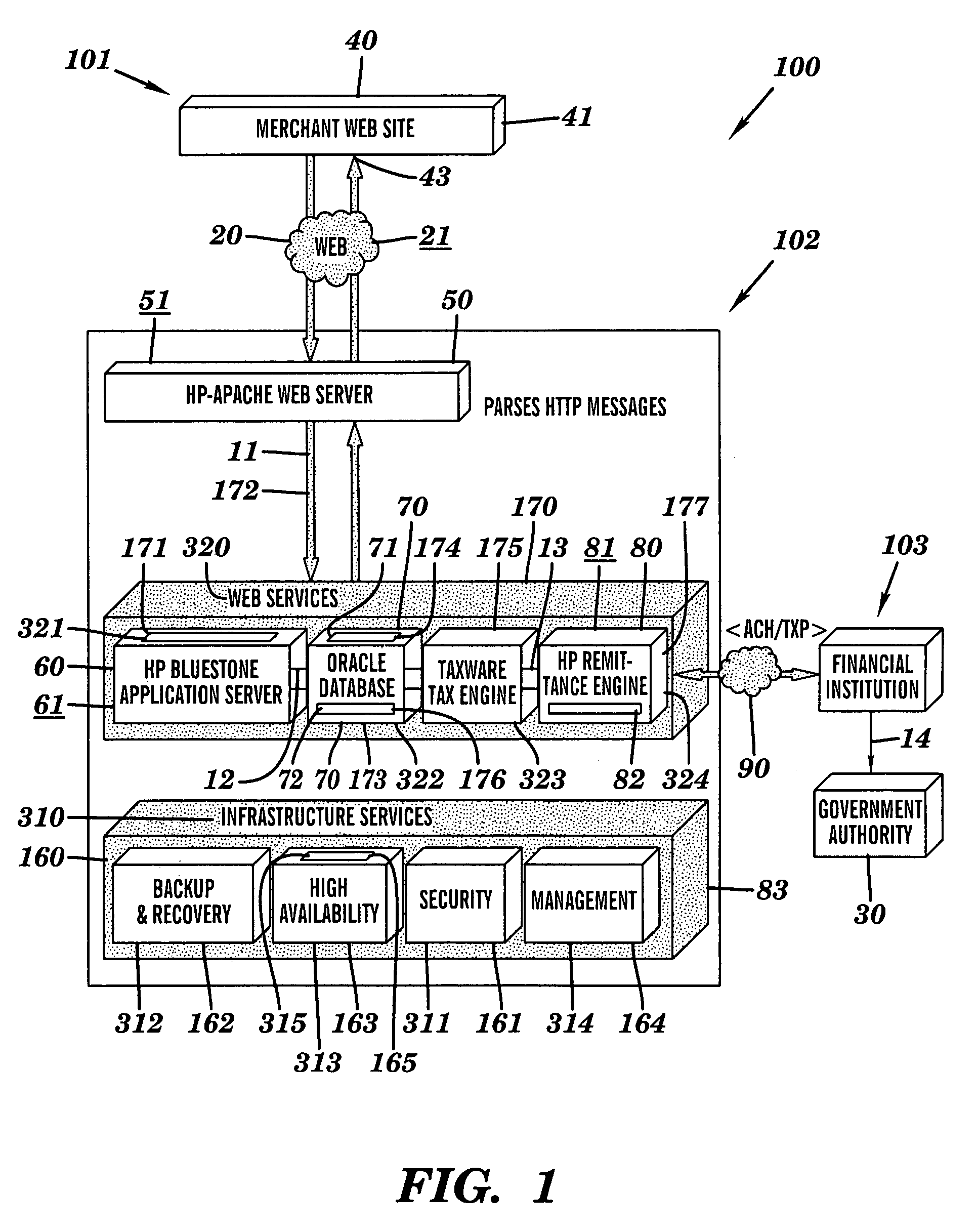

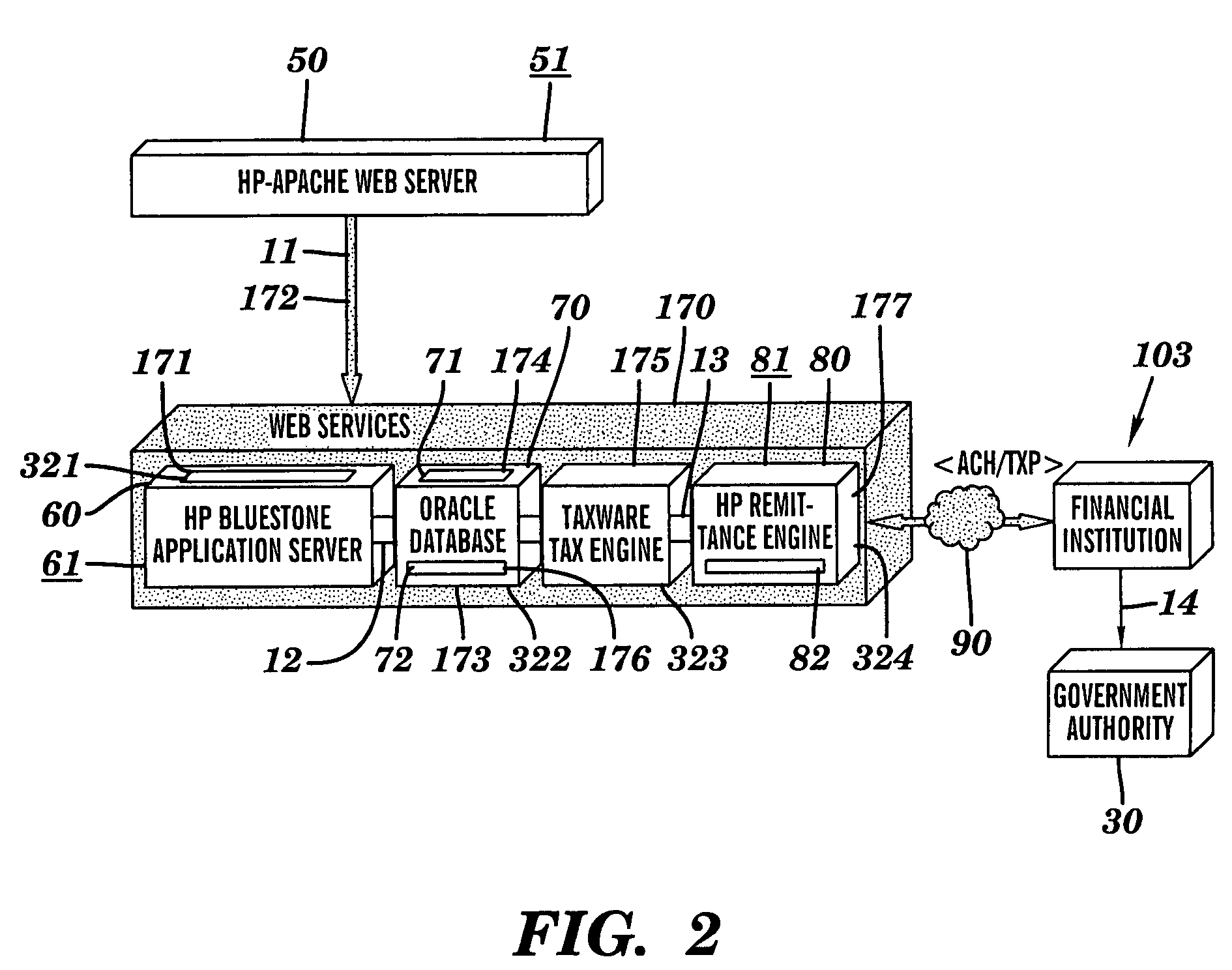

Intelligent apparatus, system and method for financial data computation, report remittance and funds transfer over an interactive communications network

InactiveUS7895097B2Minimal interventionComplete banking machinesFinanceTransaction dataDatabase file

A system for financial computation and revenue remittance over a network. A first-server providing e-content to users. A second receiving data from the first server and parsing the data. A third server receiving transactional data from the second server, parsing the data received for XML-based data and for interpreting the XML-based data for selected data processing operations. The XML-based data is stored by the third server in a first selected file of a first database, any taxes due on the corresponding transaction is computed and stored in a second selected first database file. A fourth server receiving XML-based data from the third server, converting the second selected first database file from an XML-based format to a TXP-based format for receipt by an automated clearinghouse network, and periodically transmitting the second file to a selected financial institution for remission of funds corresponding to the transactional data to the government authority.

Owner:HEWLETT PACKARD DEV CO LP

Remote ordering device

InactiveUS8123130B2Correct orderMore production timeComplete banking machinesTicket-issuing apparatusWi-FiDisplay device

A remote ordering device having a two-way wireless communications input device with a display for sending and receiving data and a data receiving station to send and receive data, process orders and keep track of accounts, inventory and retain other data as required. The receiving station can be in communication with other receiving stations to forward orders or data. The receiving station can provide instructions to a person or machine to fill orders at any desired location. The remote ordering device can scan in checks or present an electronic version of a check to the data receiving station for payment through an automated clearing house. The two-way communications can be by cell phone through a telephone network alone or also through the internet to the data receiving station. The communications can also be through Wi-Fi and the internet and use a PDA or a computer for data input and reading.

Owner:REMOTE

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com