Patents

Literature

720 results about "Transaction Type" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

A transaction type is the combination of a transaction source type and a transaction action. It is used to classify a particular transaction for reporting and querying purposes. Oracle Inventory also uses transaction types to identify certain transactions to include in historical usage calculations for ABC analysis or forecasting.

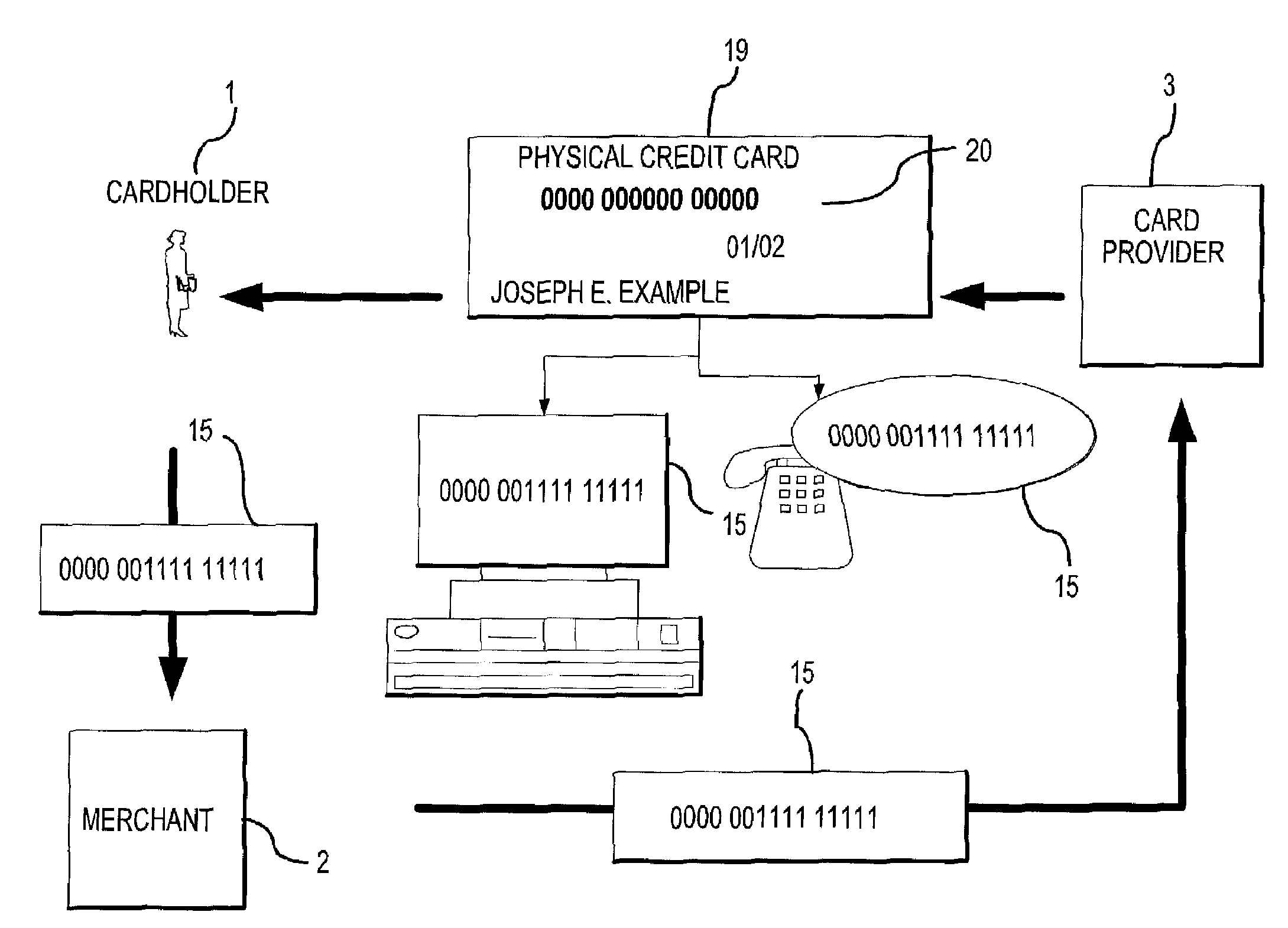

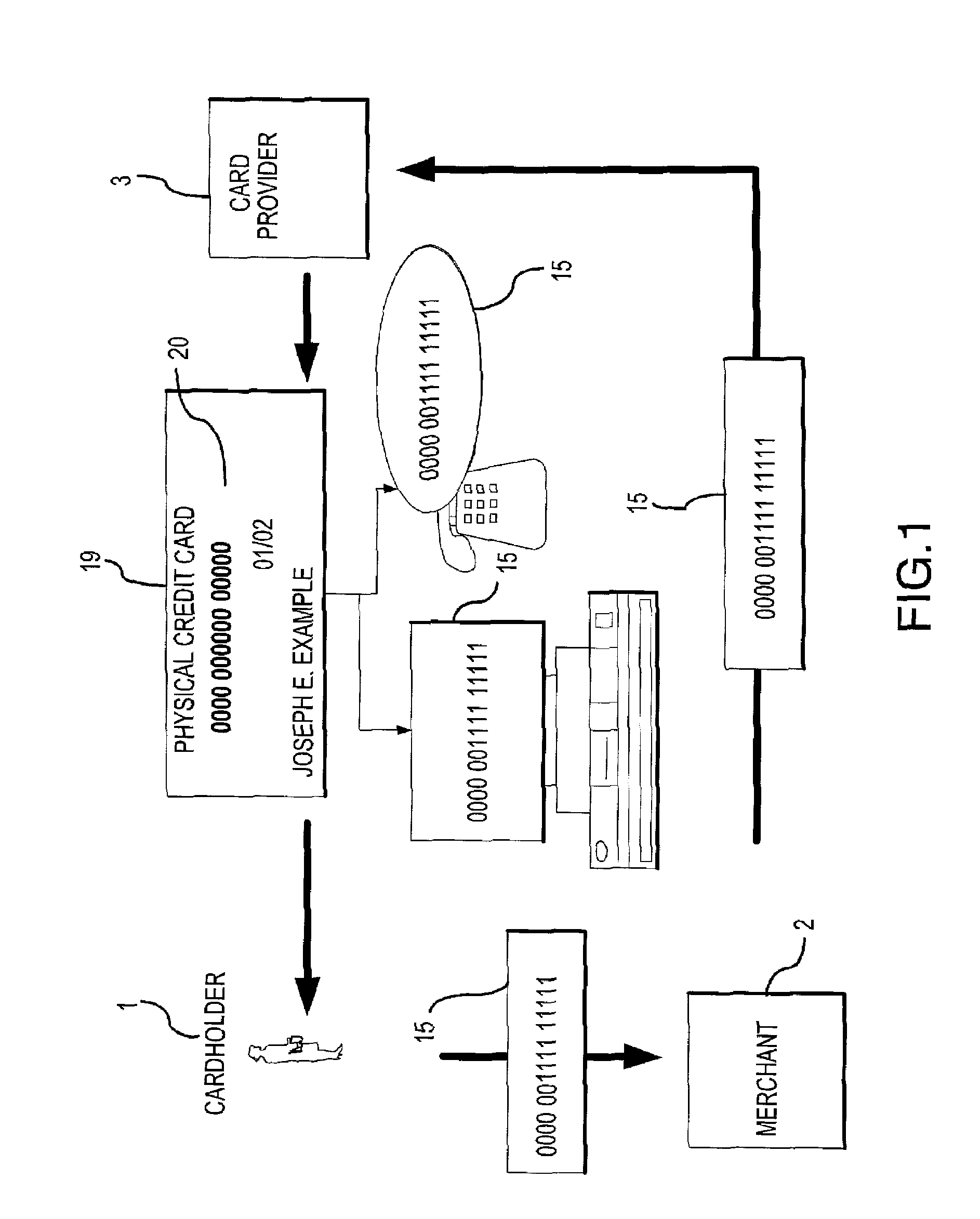

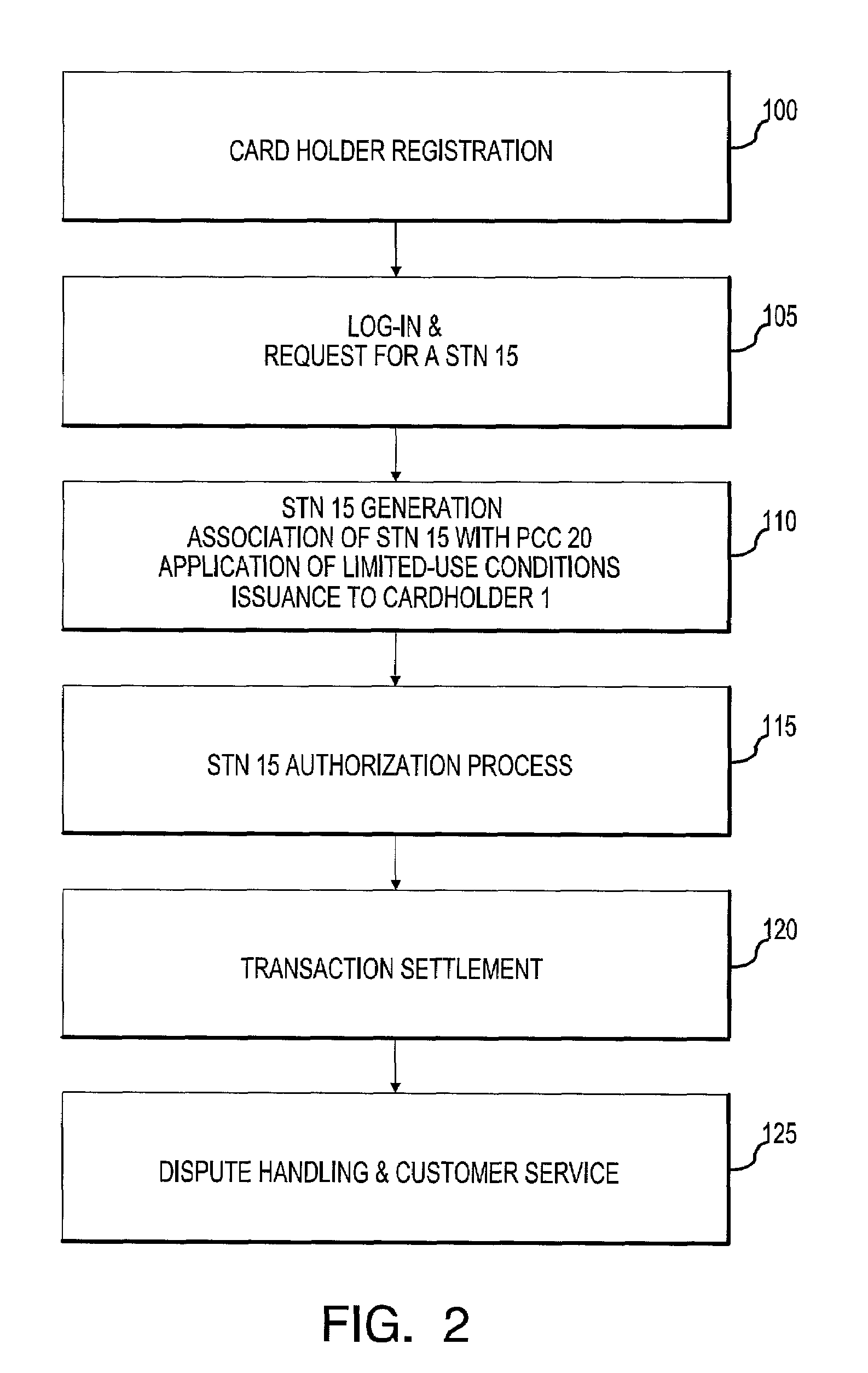

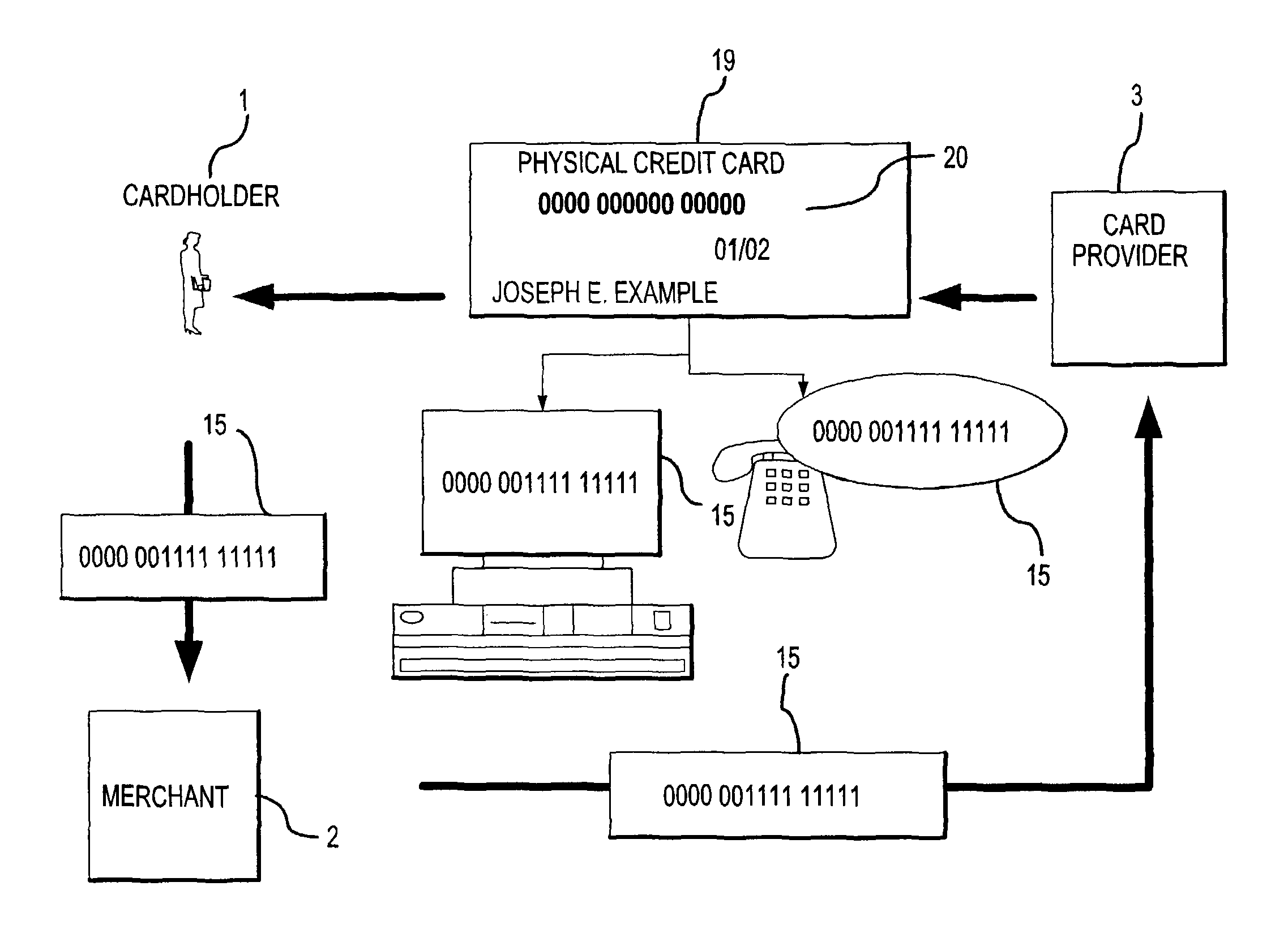

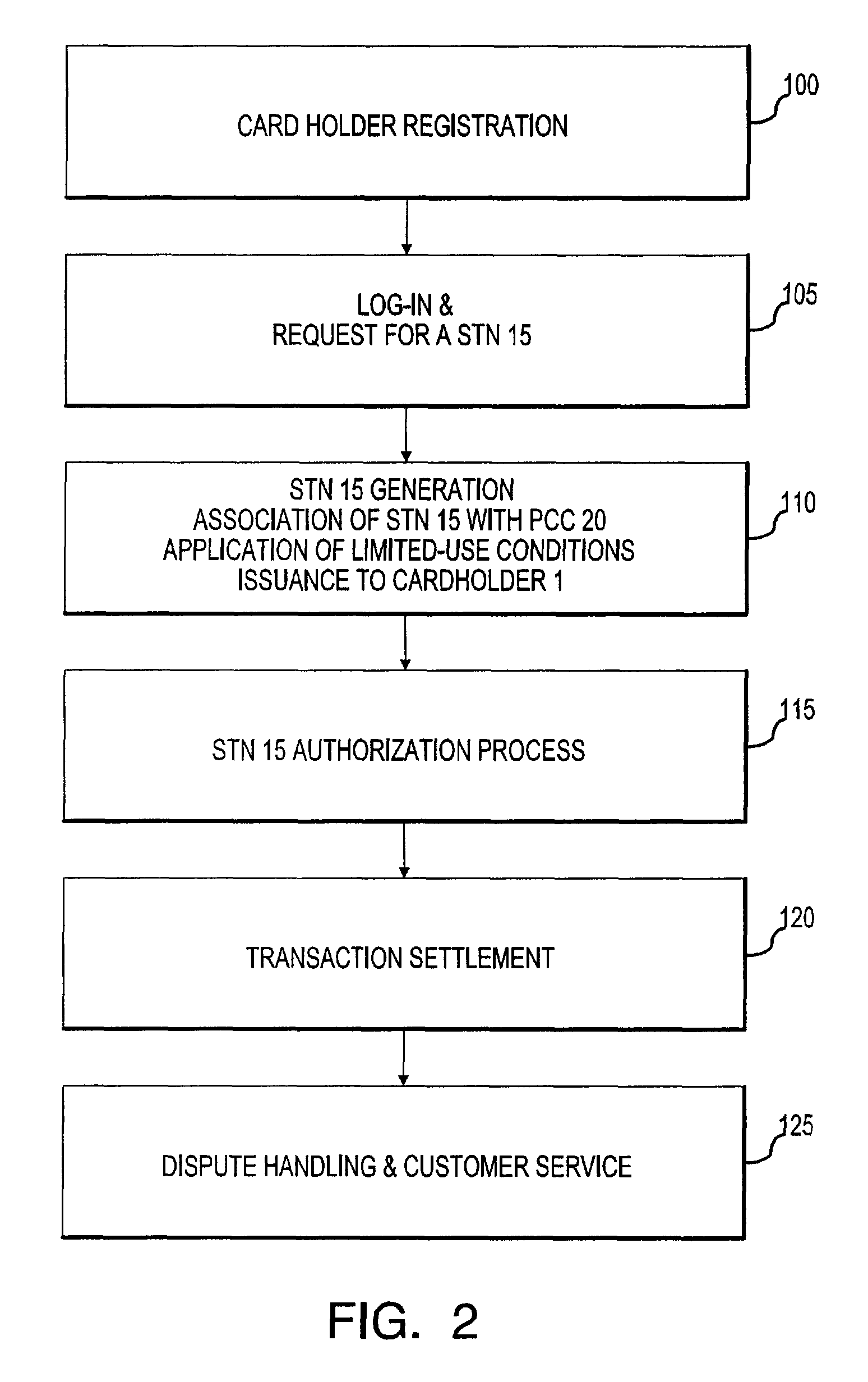

System for facilitating a transaction

The present invention provides a system and method for facilitating a transaction using a secondary transaction number that is associated with a cardholder's primary account. The cardholder provides the secondary transaction number, often with limited-use conditions associated therewith, to a merchant to facilitate a more secure and confident transaction.

Owner:LIBERTY PEAK VENTURES LLC

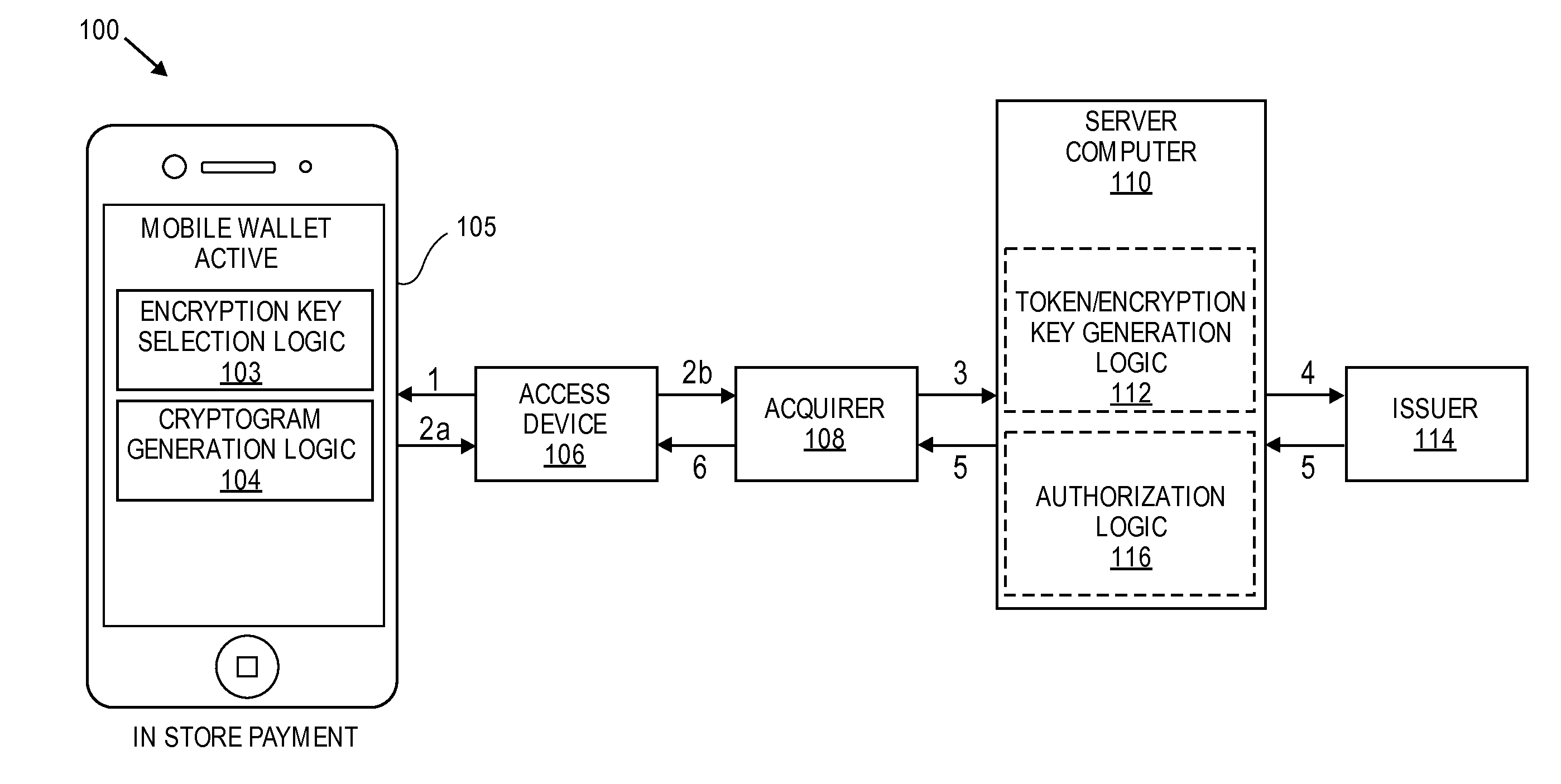

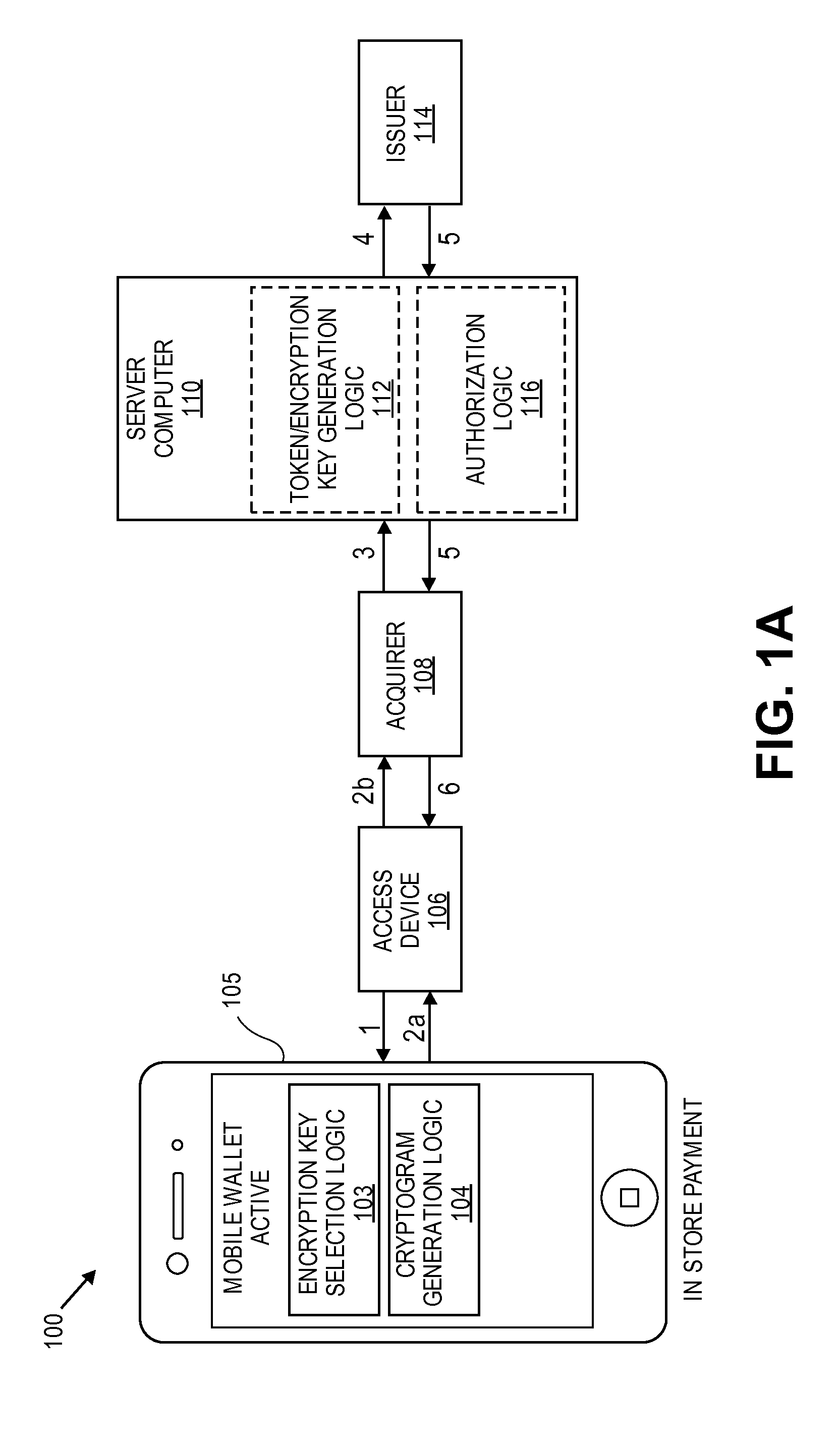

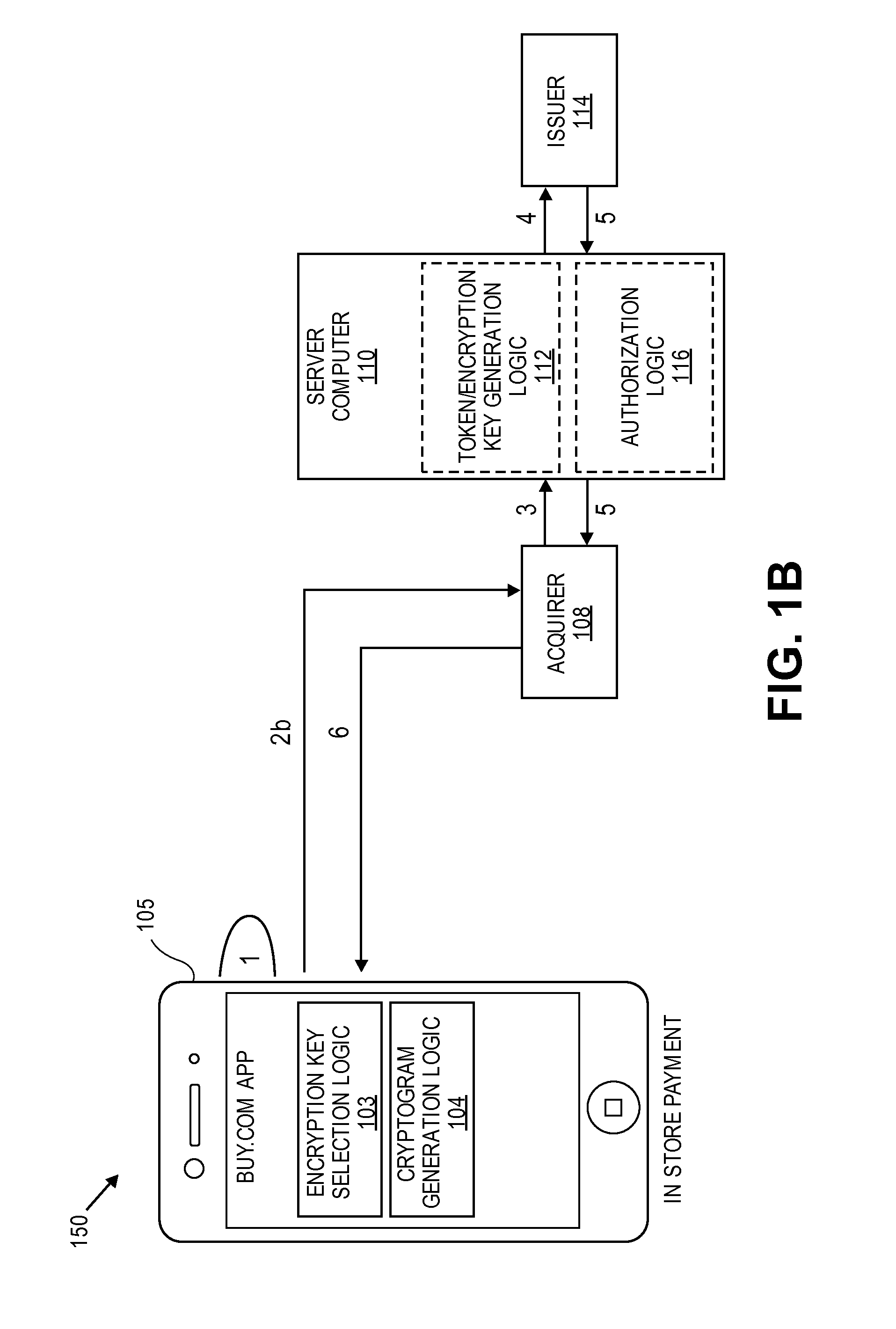

Transaction Risk Based Token

Embodiments of the invention provision multiple payment tokens on a communication device. The communication device may be provisioned with multiple limited use keys (LUK), each LUK being associated with a specific type of transaction. When the communication device is used for a transaction, the communication device automatically determines a type of the transaction and selects an appropriate LUK based on the determined transaction type. The selected LUK may be used to create a cryptogram, which can be used to verify the transaction.

Owner:VISA INT SERVICE ASSOC

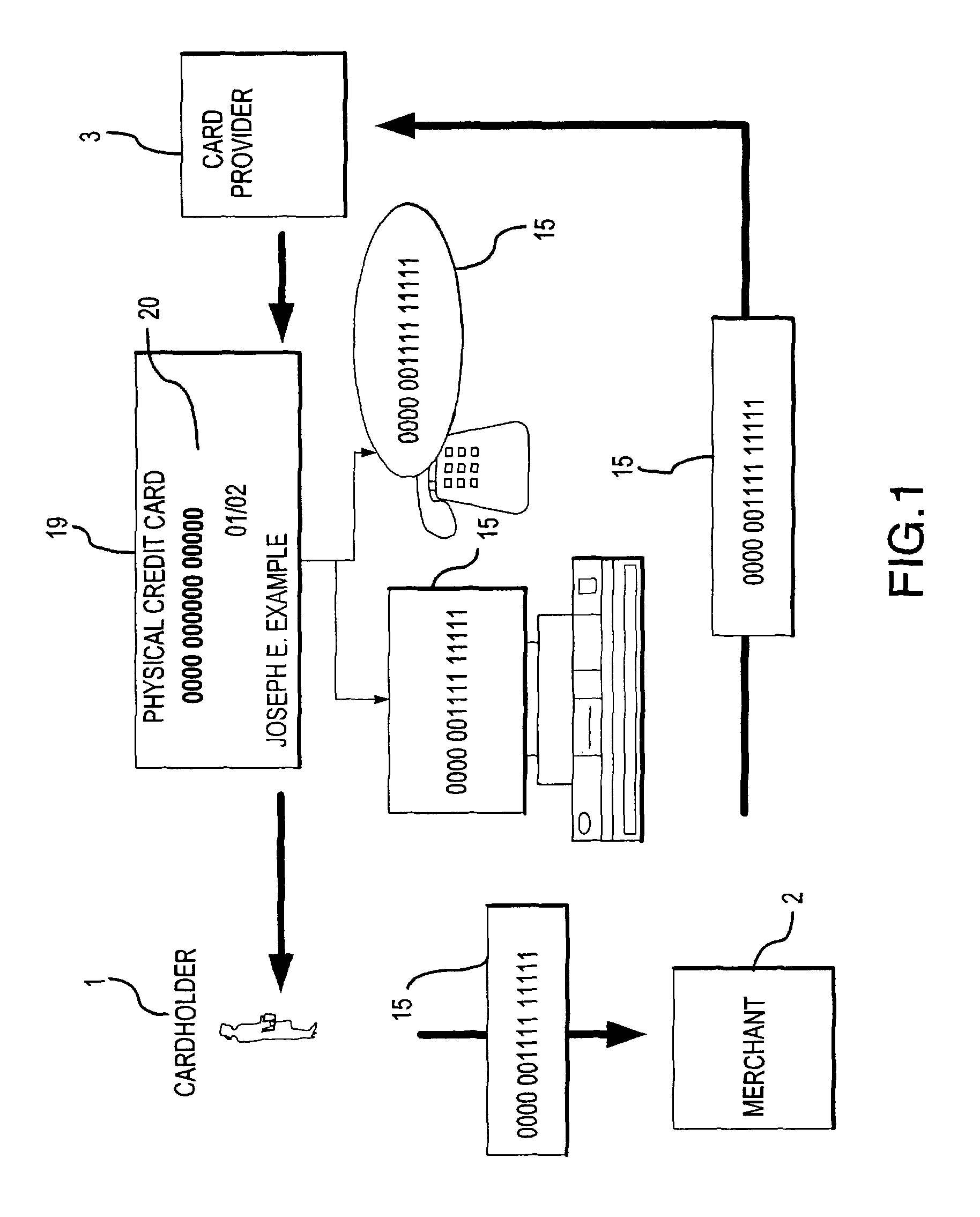

System for facilitating a transaction

The present invention provides a system and method for facilitating a transaction using a secondary transaction number that is associated with a cardholder's primary account. The cardholder provides the secondary transaction number, often with limited-use conditions associated therewith, to a merchant to facilitate a more secure and confident transaction.

Owner:LIBERTY PEAK VENTURES LLC

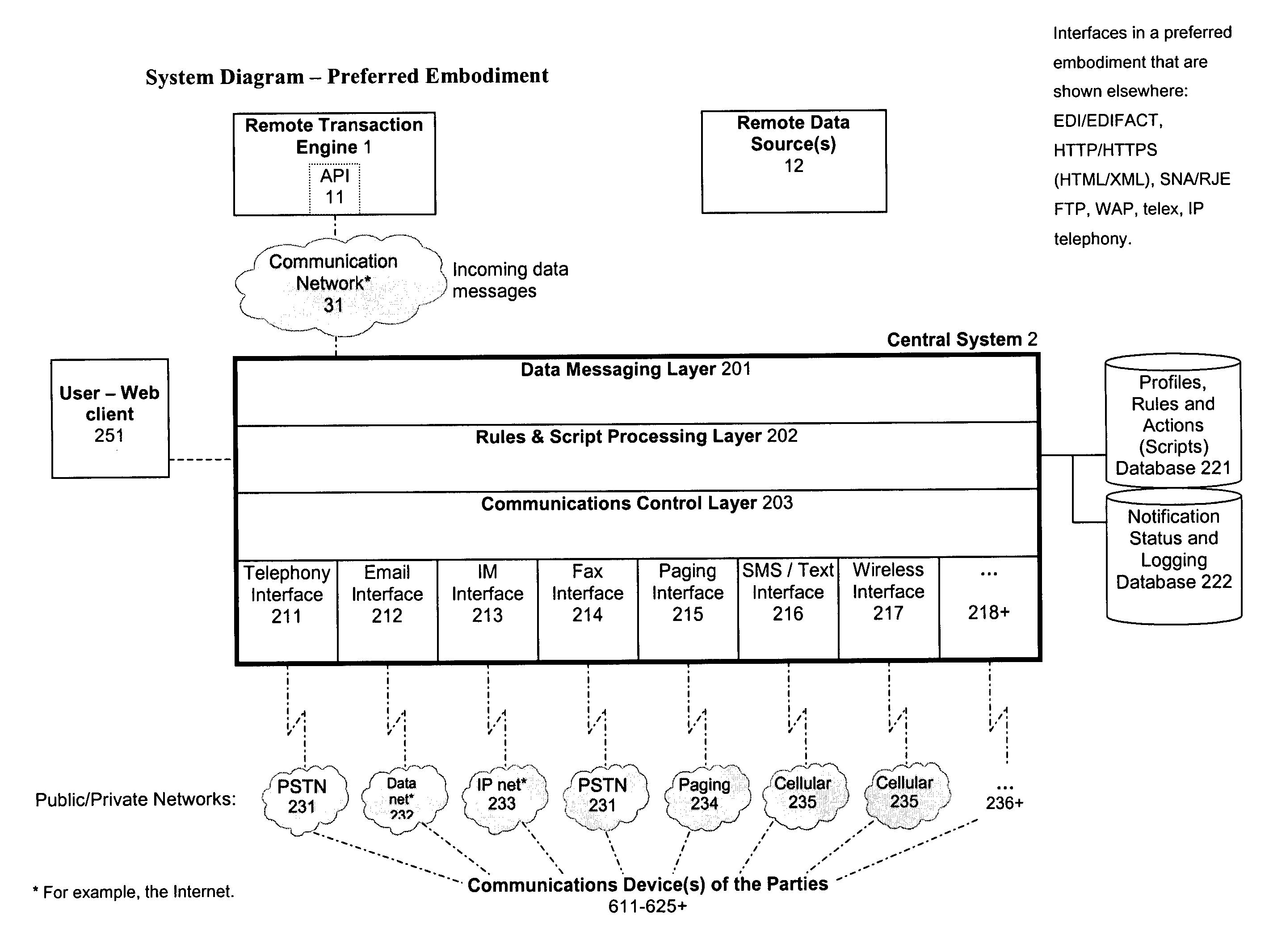

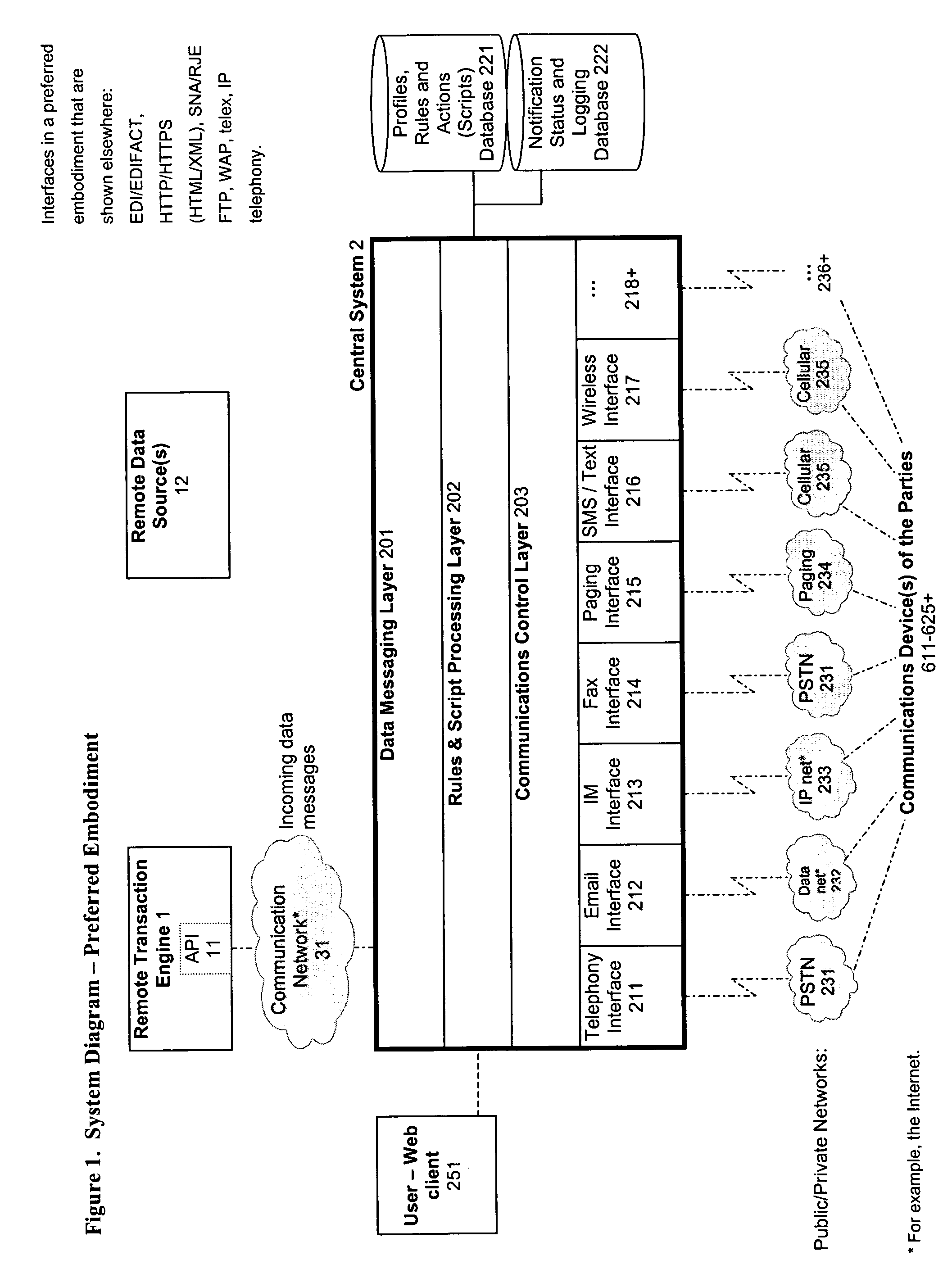

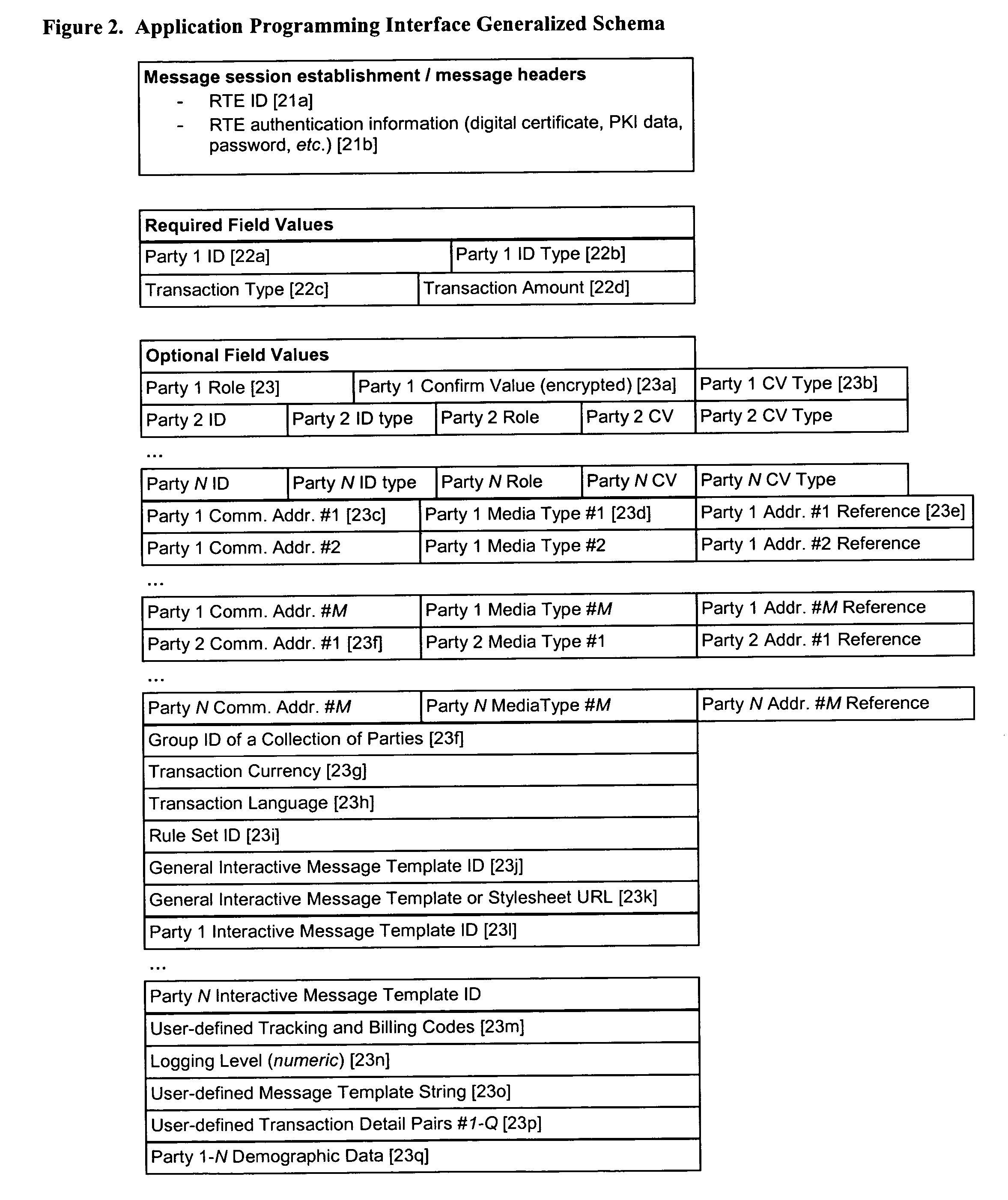

System and method for verification, authentication, and notification of a transaction

ActiveUS20040078340A1Increase valueFinanceBuying/selling/leasing transactionsTelecommunications linkSocial Security number

A system and method for verifying, authenticating, and providing notification of a transaction, such as a commercial or financial transaction, with and / or to at least one party identified as engaging in the transaction and / or identified as having a potential interest in the transaction or type of transaction, are provided. A central system accepts information regarding a transaction, including information about at least one party identified as engaging in the transaction, such as by a credit account number or Social Security number or merchant account number, and / or identified as having a potential interest in the transaction. Based on the information regarding the transaction and any supplemental information the central system determines, the central system communicates with and / or to at least one party and / or additional or alternative parties, via at least one communications device or system having a communications address, such as a telephone number or Short Message Service address, predetermined as belonging to the at least one party and / or additional or alternative parties. Via said communications, at least one party having an interest or a potential interest in the transaction may be notified of it, and may further be enabled or required to supply additional verifying or authenticating information to the central system. If the transaction was initiated or engaged in via a communications link, such as via the Internet, said communications preferably occur over at least one different communications link and / or protocol, such as via a wireless voice network. The central system may then compute a result based on the outcomes of said communications, and may then transmit the result to the user and / or to a second system or device.

Owner:ST ISIDORE RES

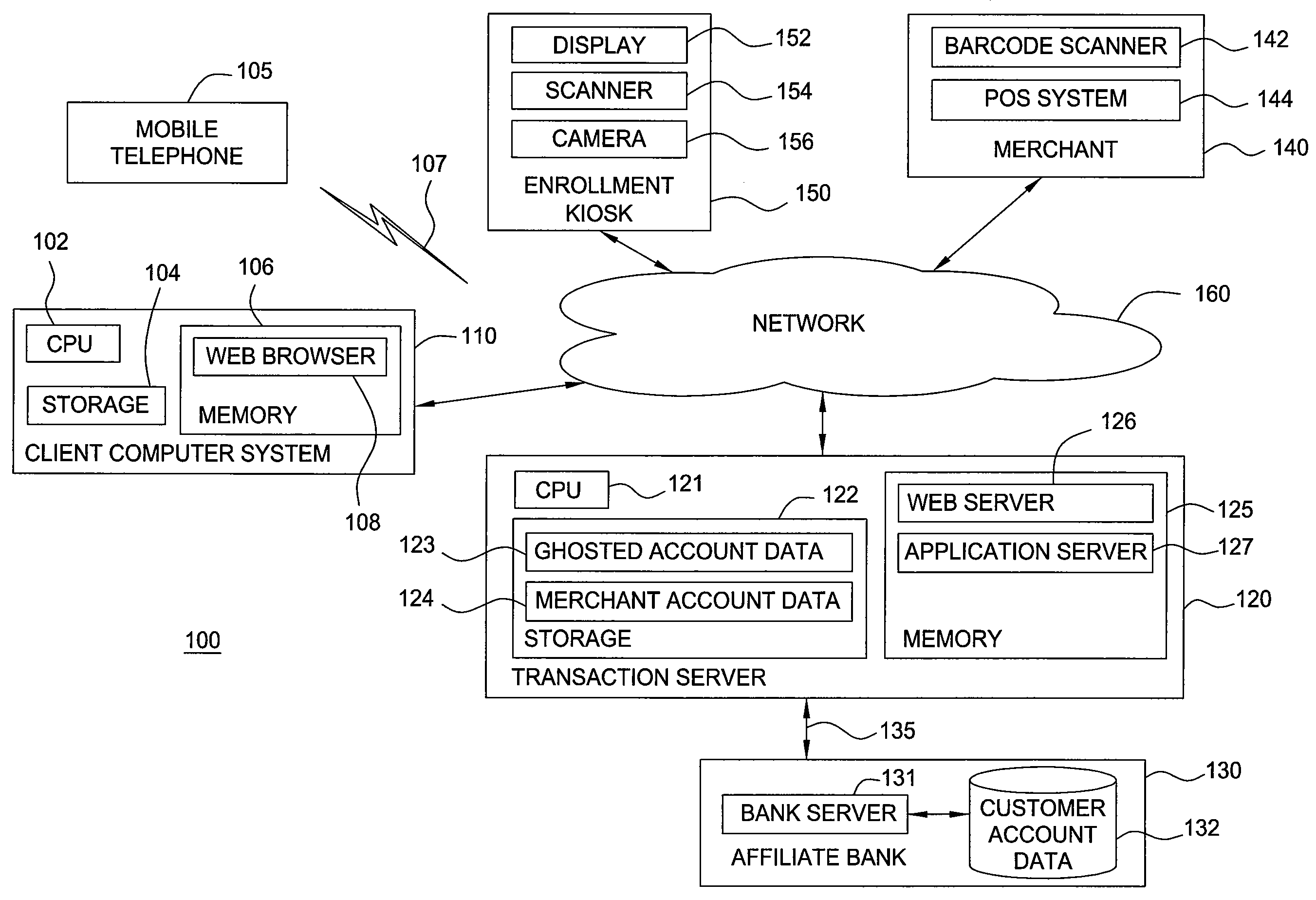

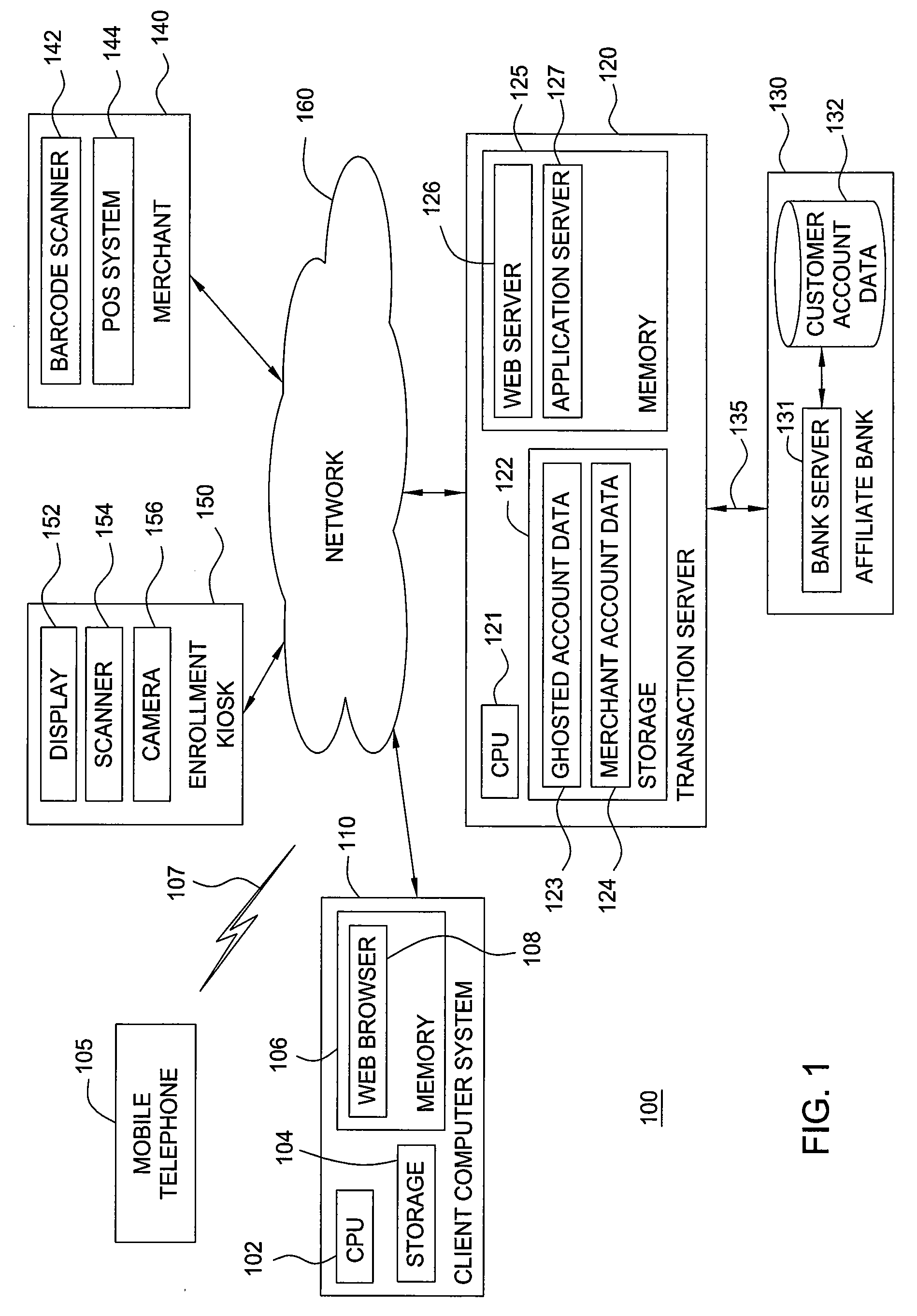

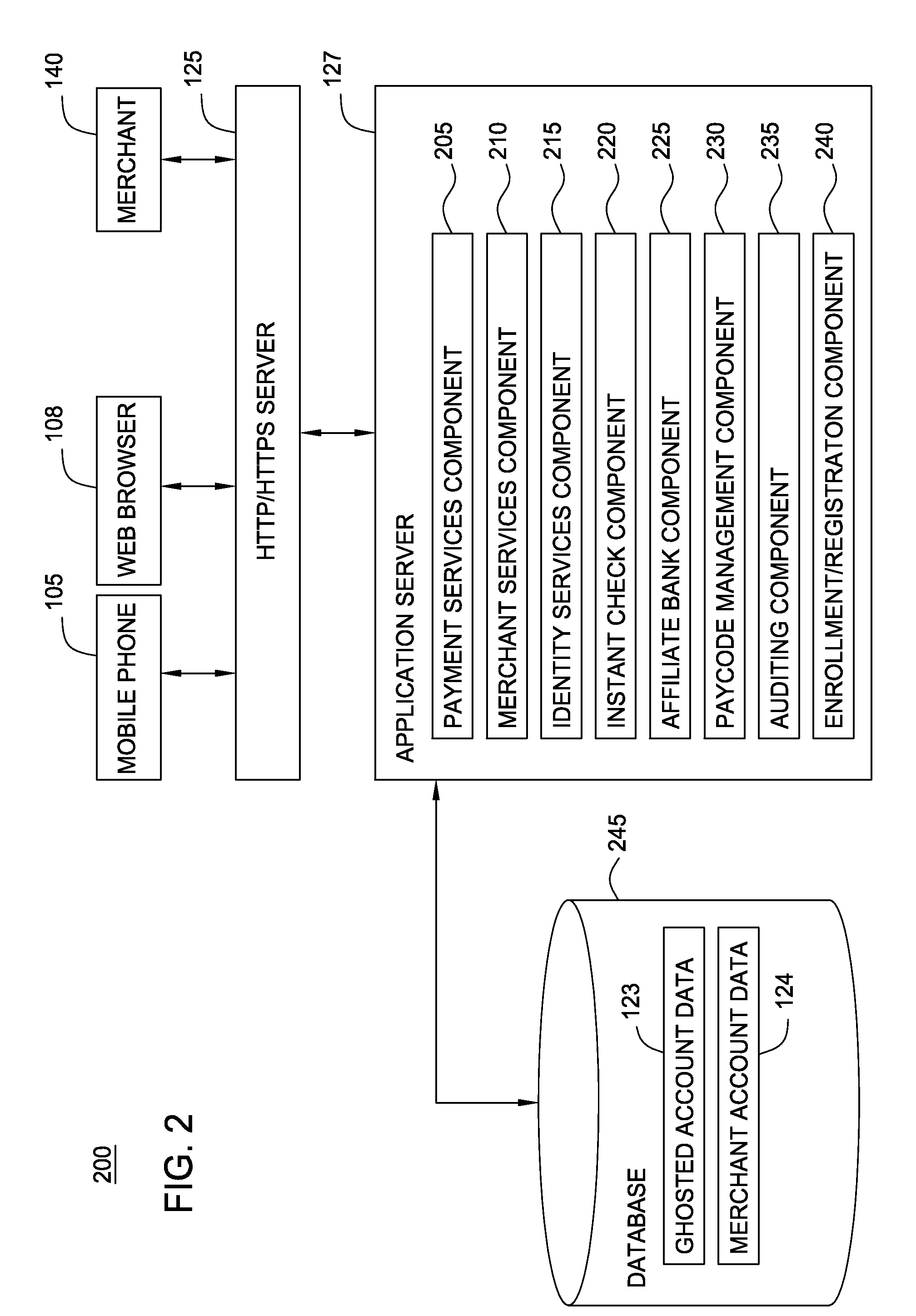

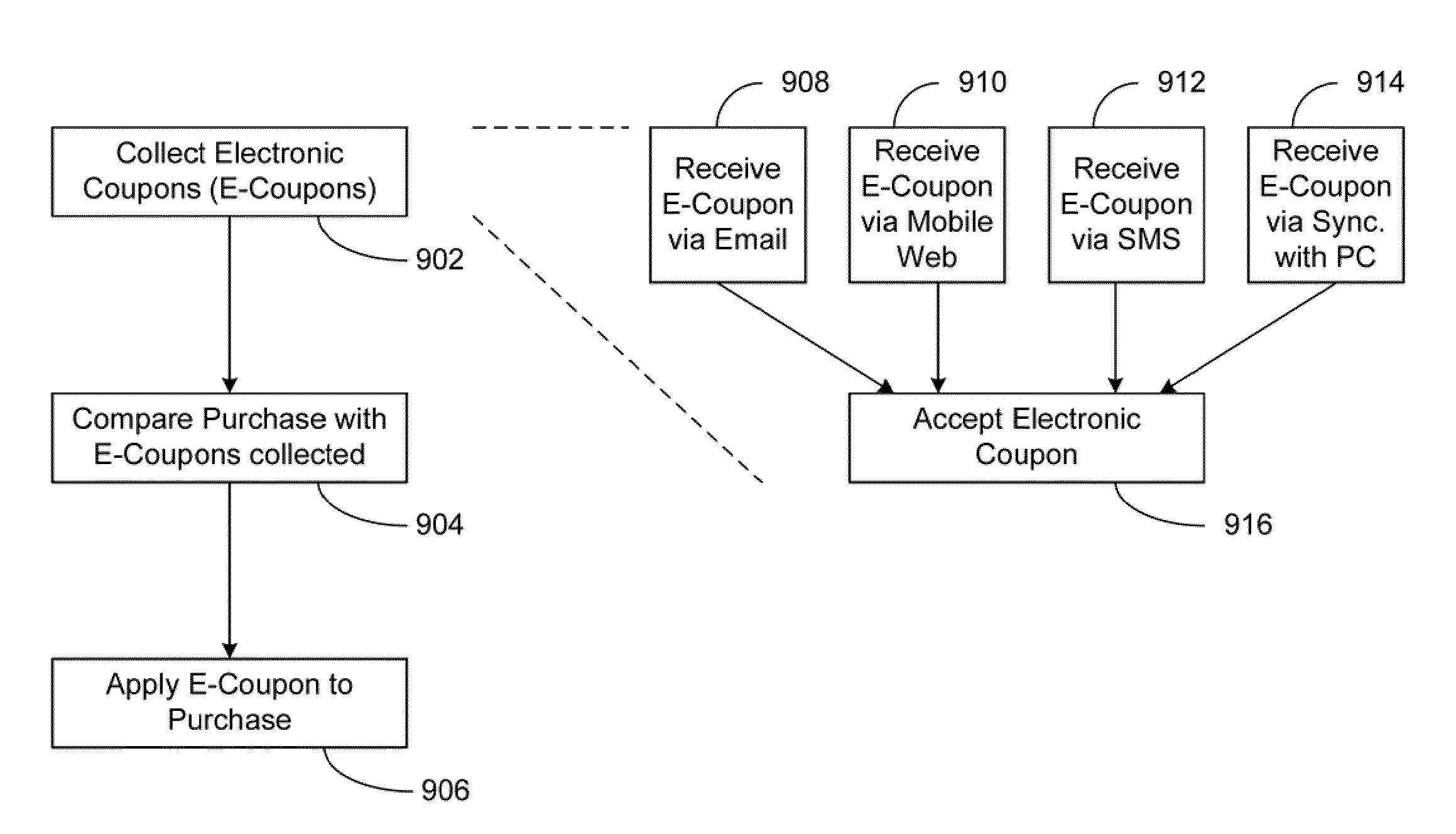

Ghosting payment account data in a mobile telephone payment transaction system

InactiveUS20090254440A1Incurs chargeFinanceSpecial service for subscribersTransaction servicePayment transaction

Techniques are disclosed for a mobile telephone, in conjunction with a payment transaction server, to be used directly as a payment device for a variety of financial transactions. Further, the transaction systems and methods for mobile telephone devices described herein allow a mobile telephone to participate in payment transactions in a manner that helps prevent identify theft and without relying on transferring amounts to / from one stored value account to another.

Owner:GLOBAL 1 ENTERPRISES

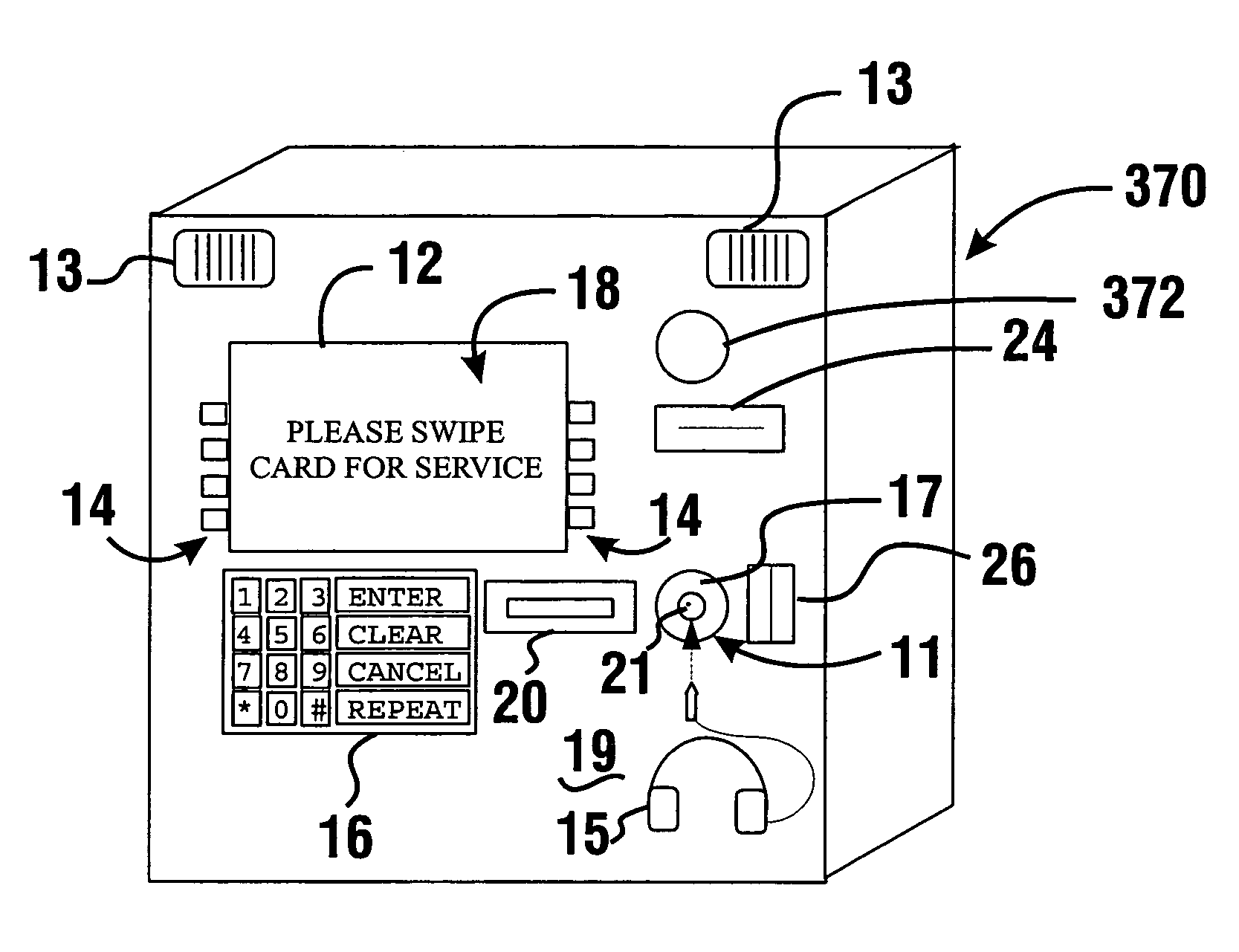

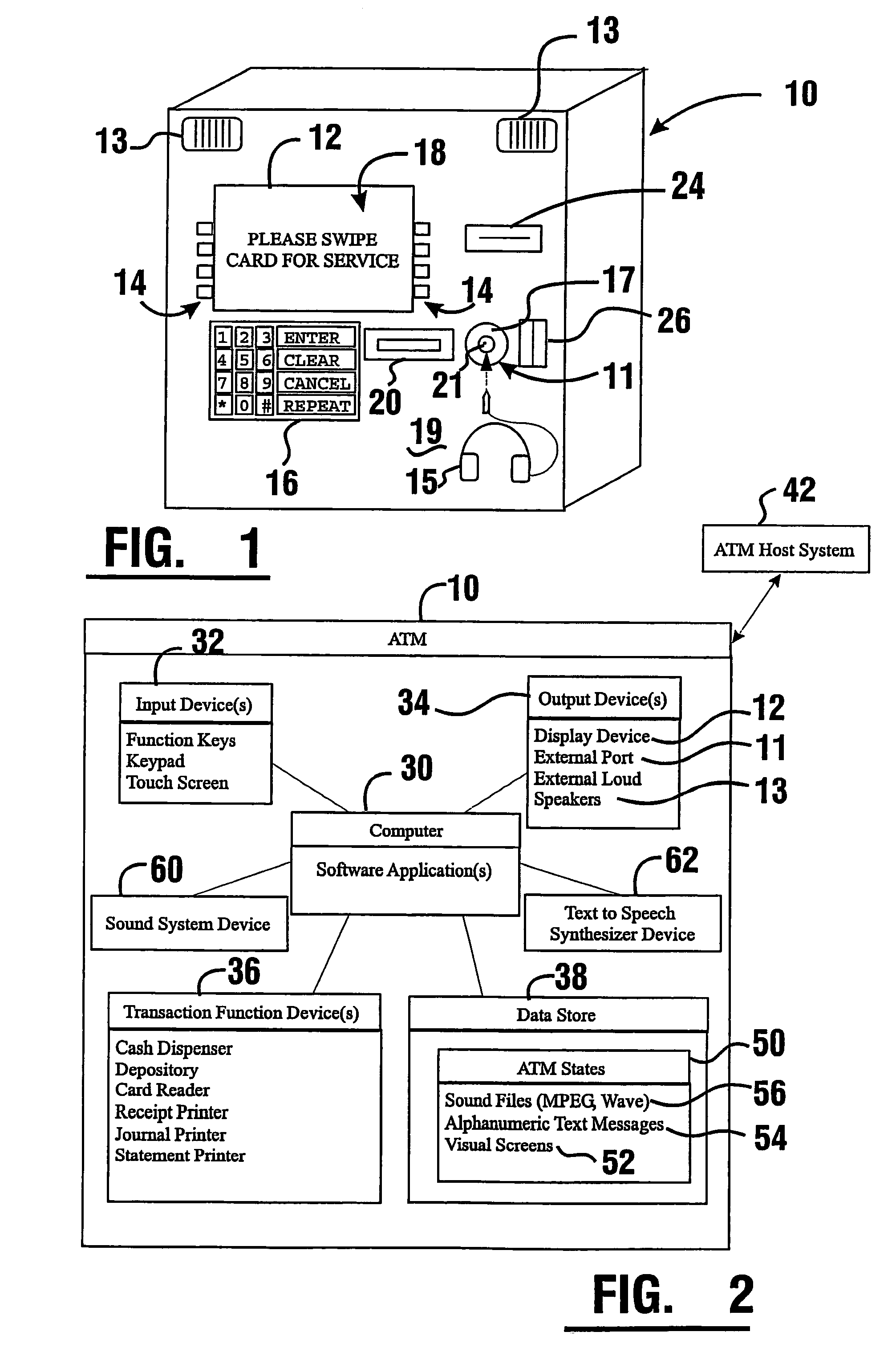

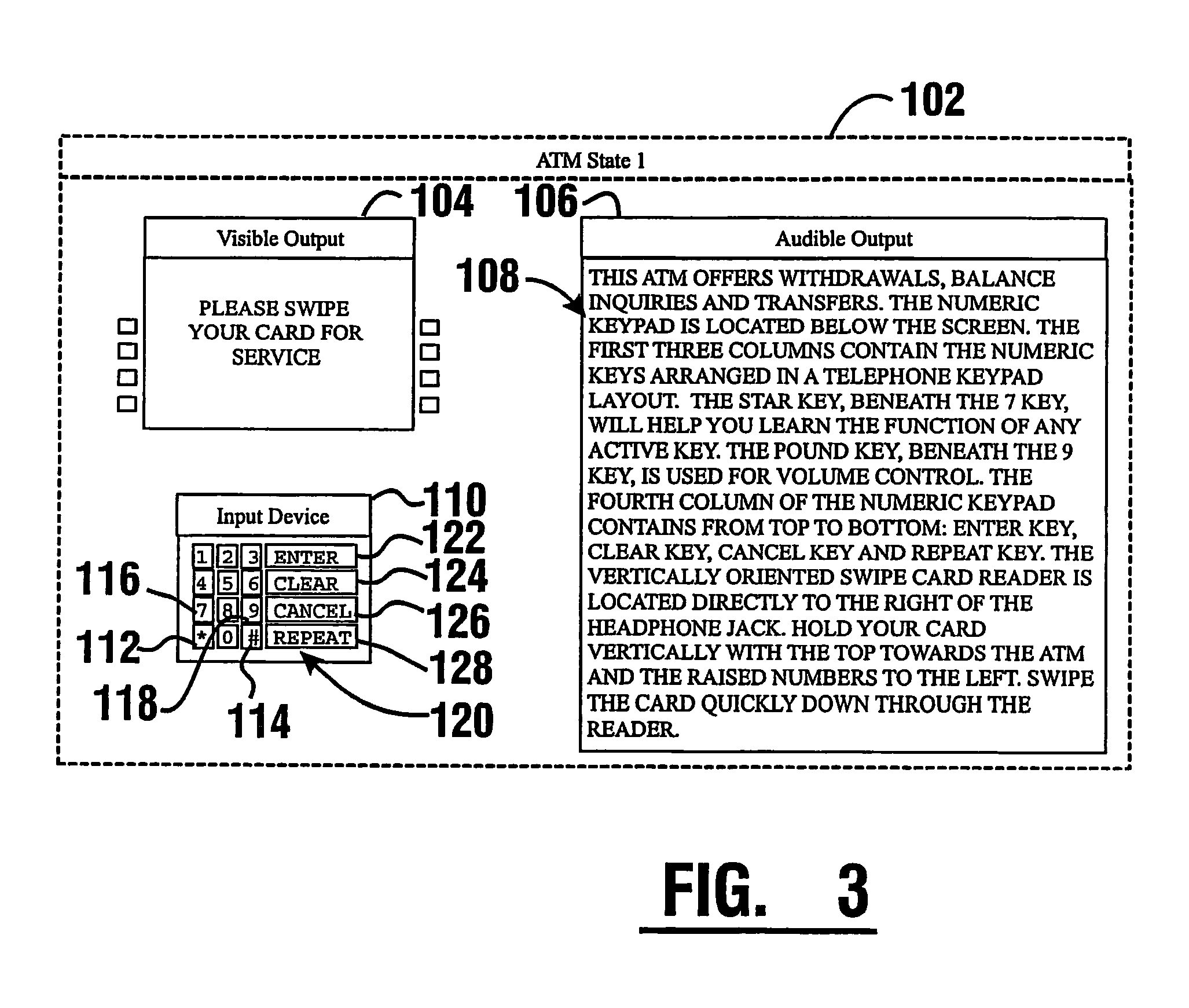

Cash dispensing automated banking machine user interface system and method

An automated banking machine is operative to enable users to operate the machine to carry out transactions such as the dispensing of cash. The exemplary machine provides audible instructions which are output through external loudspeakers, a headphone, or a handset. Rotation of a rotatable knob (372, 382) or other movable item causes the output of user selectable characters, transaction types and / or amounts corresponding to each respective position. The user selects the audible output produced in the current position of the knob for receipt by the machine as a transaction input by pressing on the knob. Characters and other selectable inputs corresponding to knob positions can be varied by the computer in the machine to reduce the risk of a criminal intercepting the user's inputs to the machine.

Owner:DIEBOLD NIXDORF

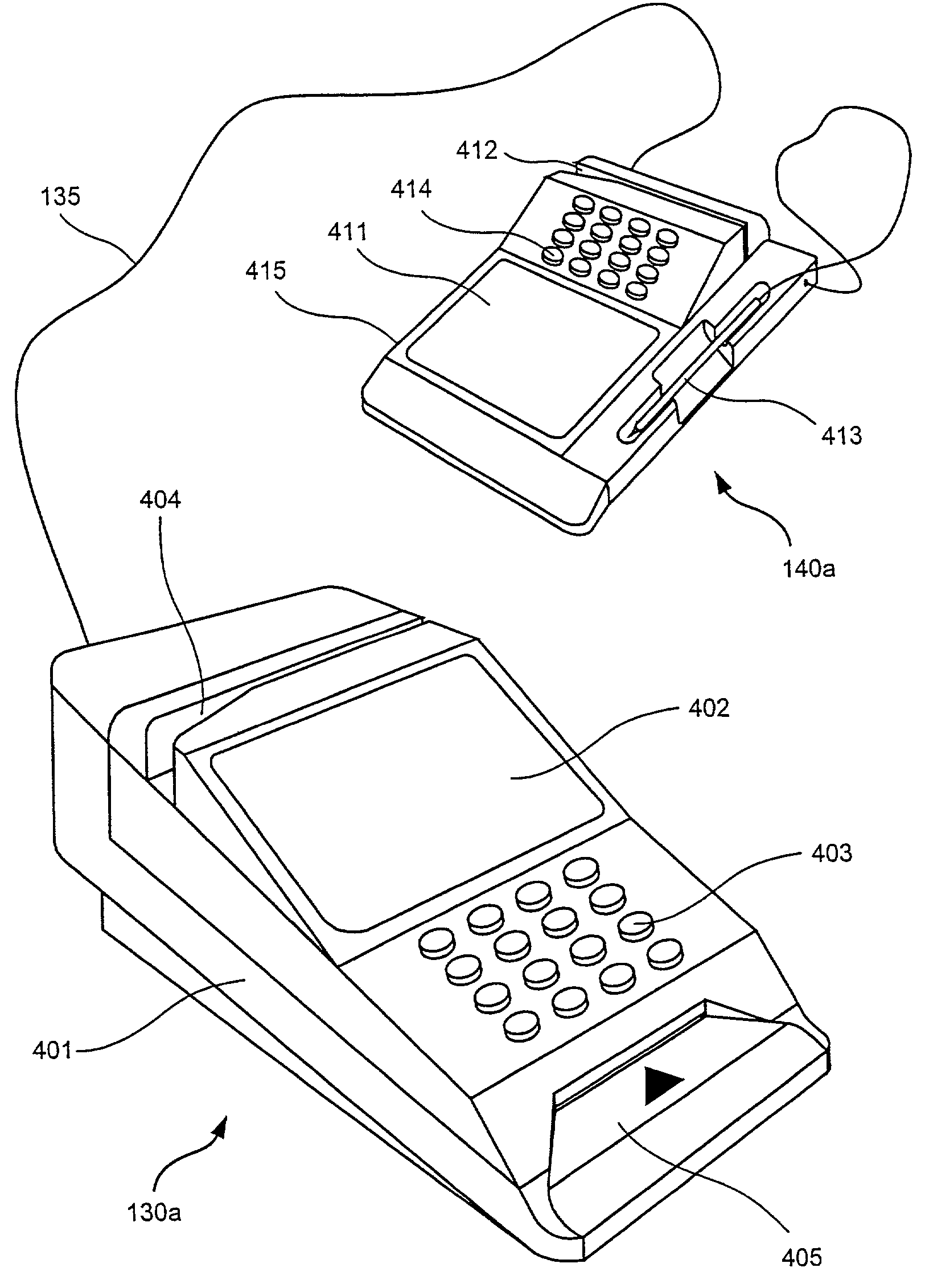

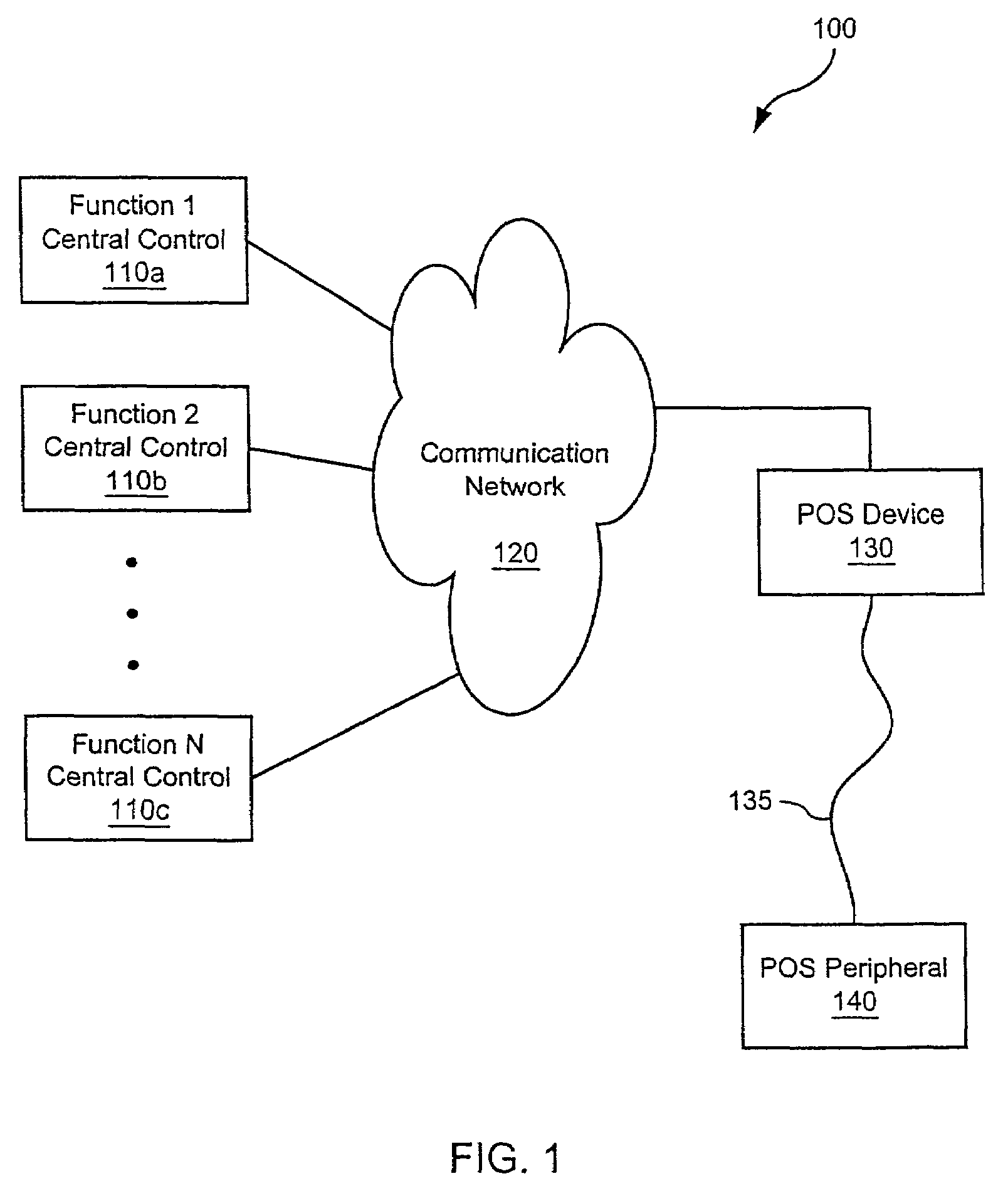

Systems and methods for performing transactions at a point-of-sale

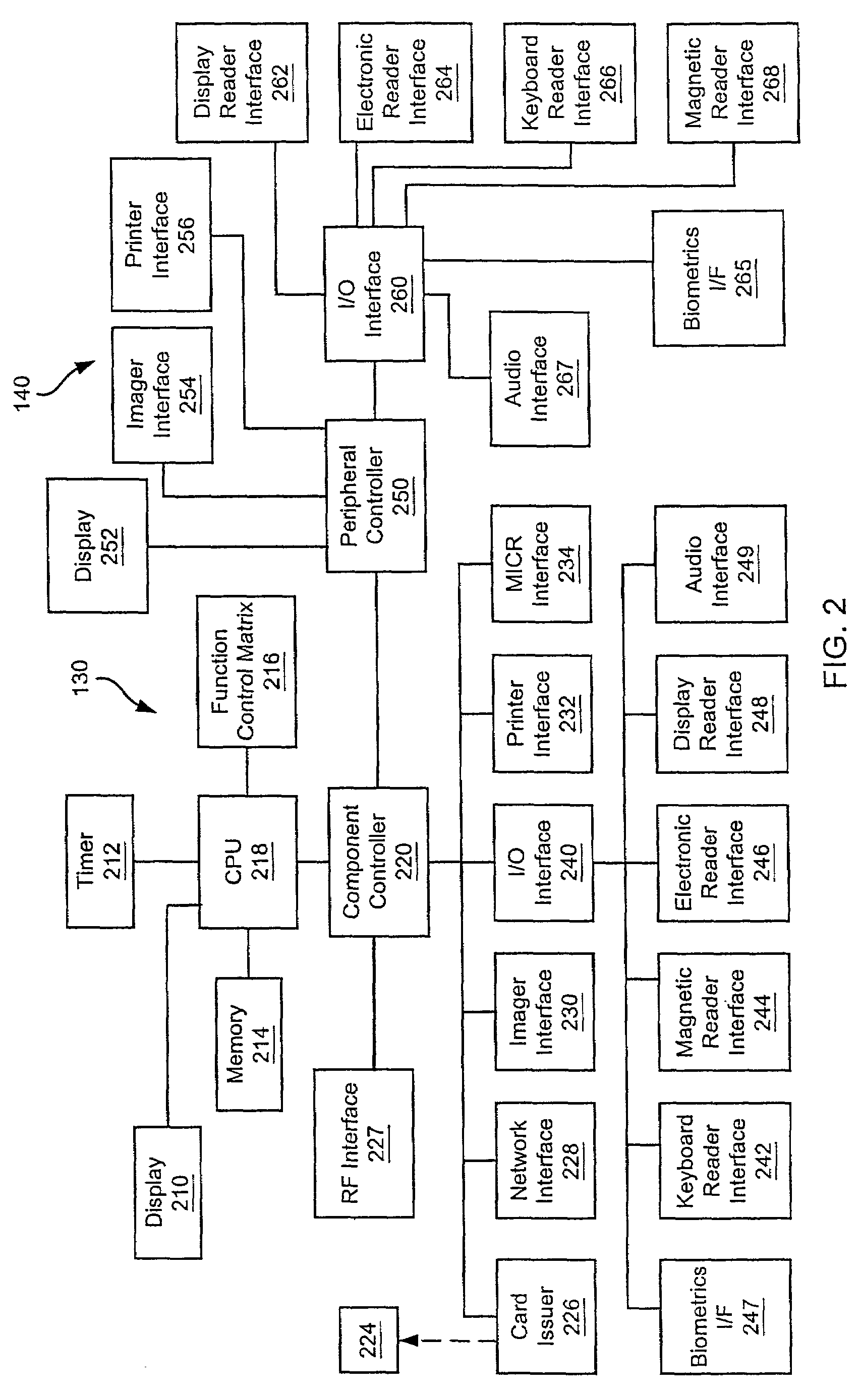

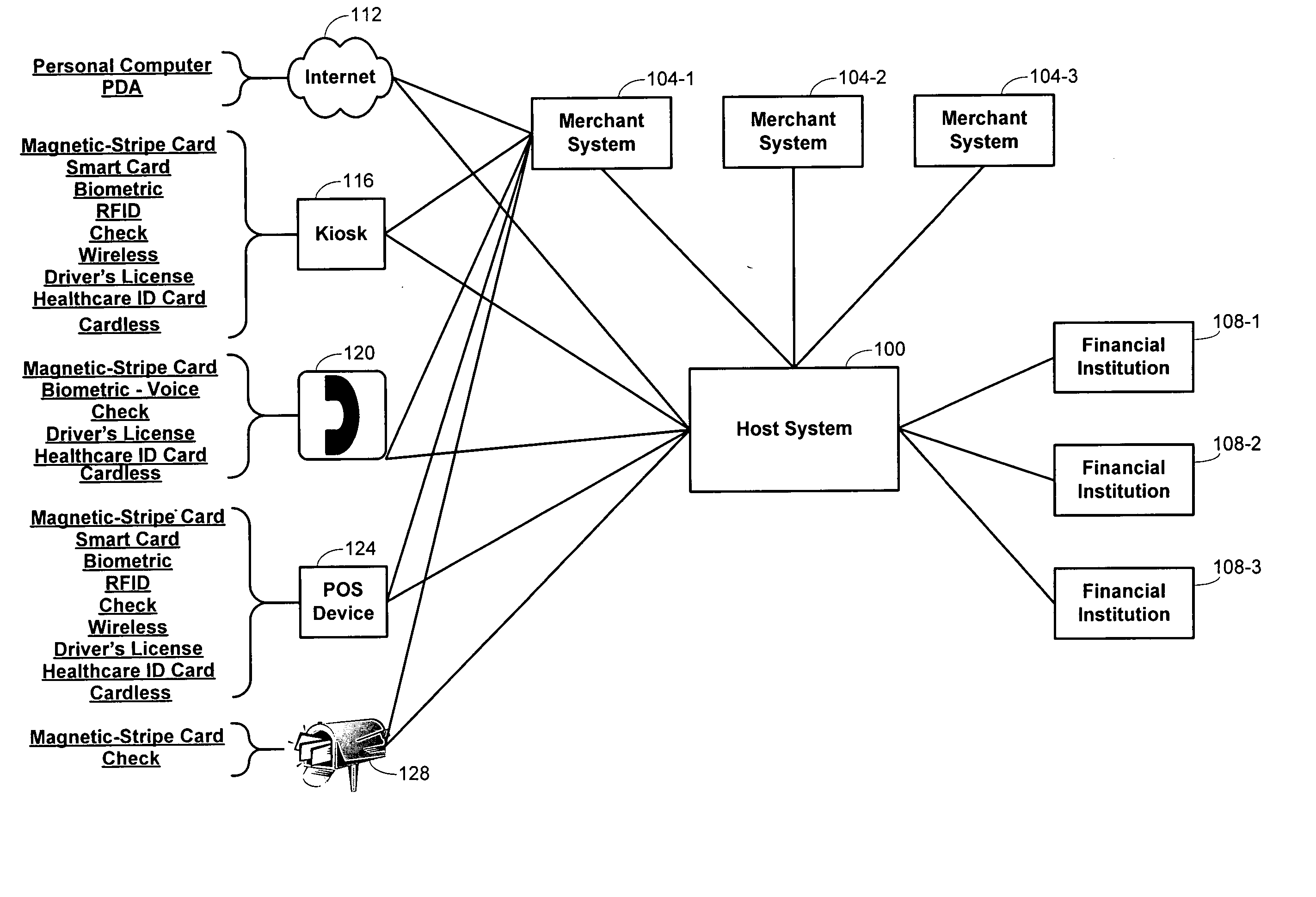

A point-of-sale device useful in relation to a variety of circumstances and / or utilization methods. Various implementations of such point-of-sale devices are disclosed. For example, one particular point-of-sale device includes a base unit adapted for performing merchant functions and a peripheral unit adapted to perform customer functions. The base unit can include a base unit housing with a processor disposed therein and capable of supporting a variety of transaction types.

Owner:FIRST DATA +1

Methods and systems for processing transactions

InactiveUS20050192895A1Increase flexibilityIncrease choiceFinanceBuying/selling/leasing transactionsTransaction TypeMonetary Amount

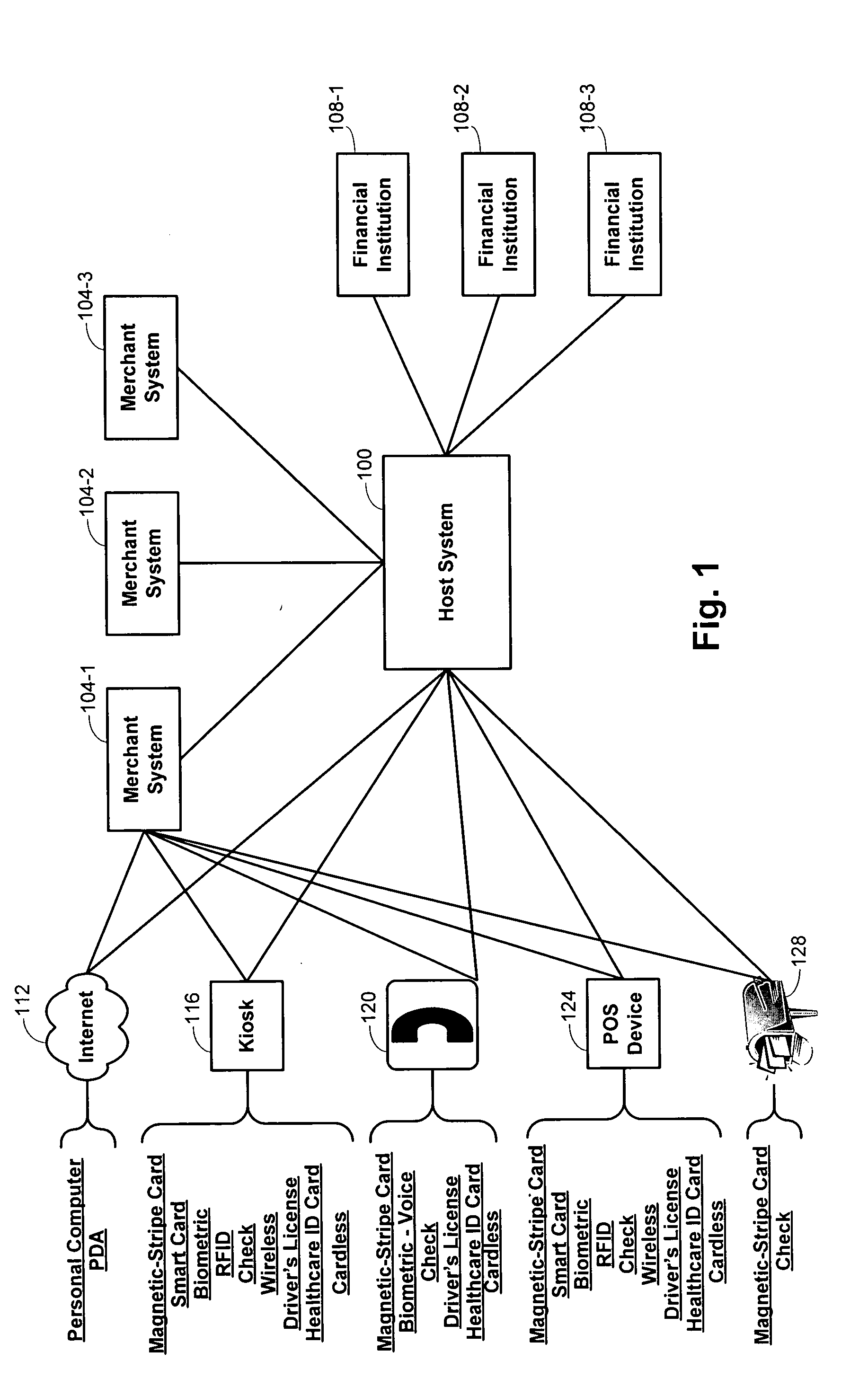

Methods and systems are provided for processing a transaction between a first party and a second party. Information defining terms of the transaction and identifying a presentation instrument are received at a host system. Preference information associated with the presentation instrument is retrieved with the host system. The preference information specifies terms for an allocation of transaction amounts among multiple transaction types. An amount for the transaction is allocated among the transaction types in accordance with terms of the transaction and the terms for the allocation.

Owner:FIRST DATA

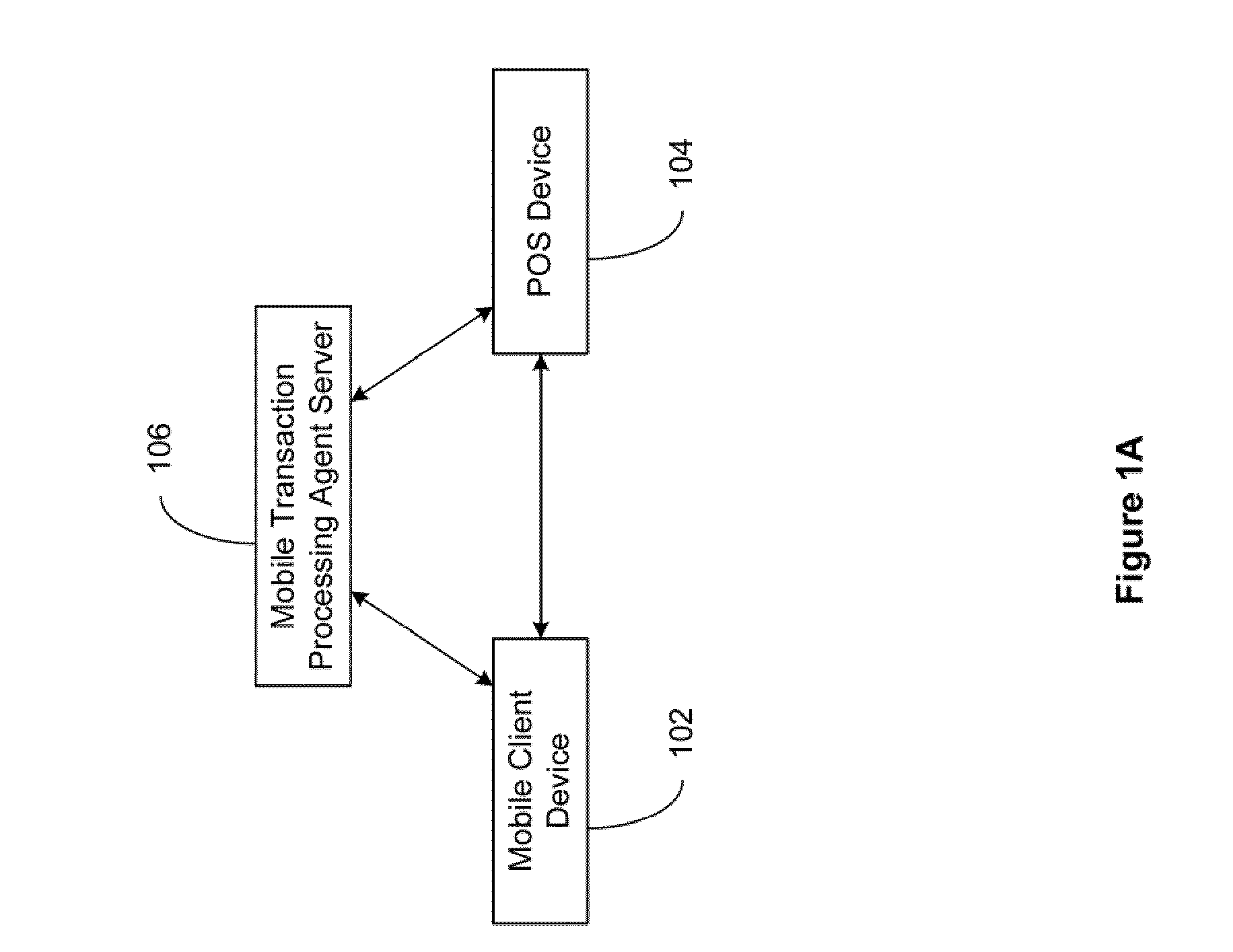

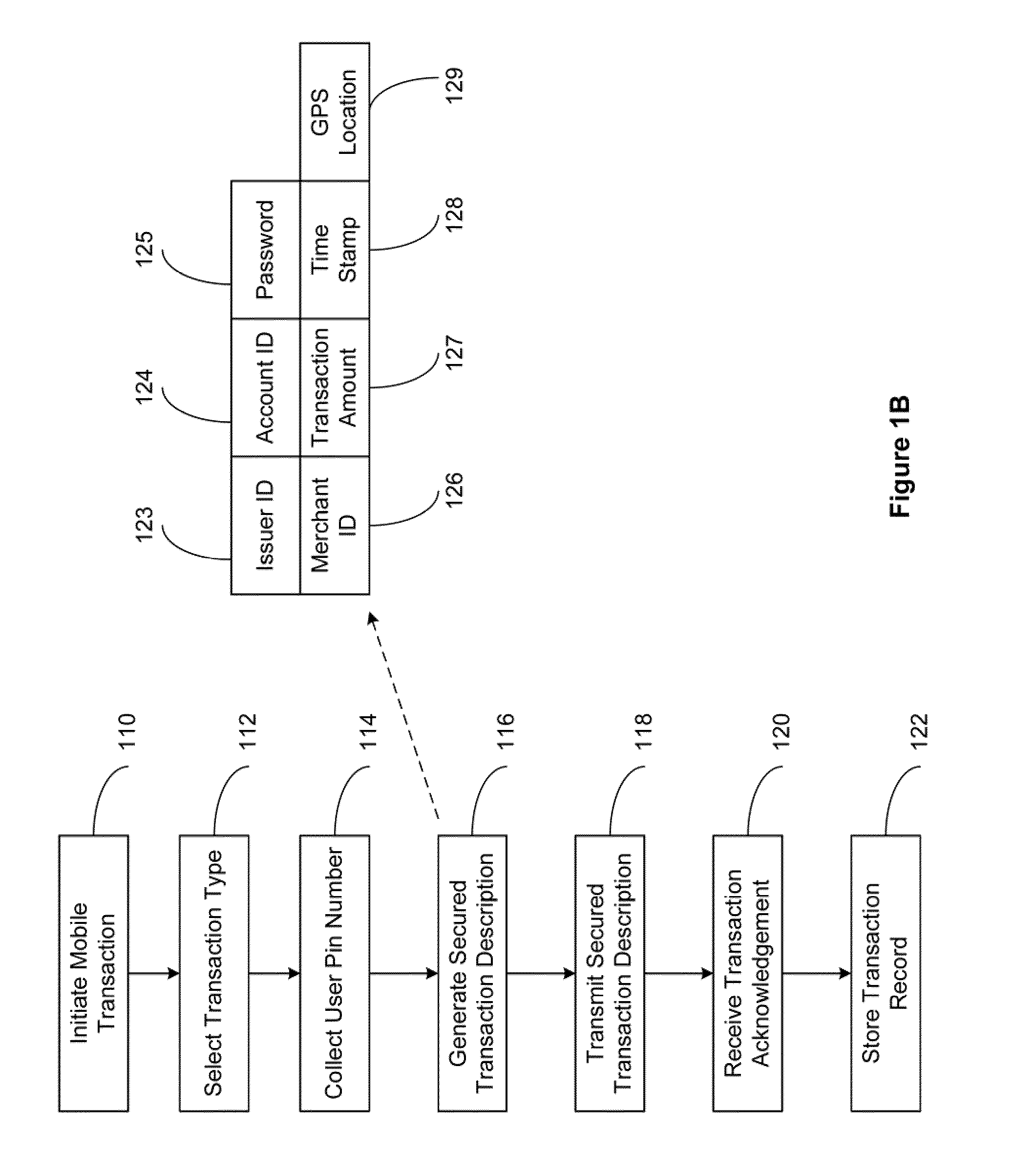

Secured Mobile Transaction Device

InactiveUS20110191161A1Improve securityFinanceBuying/selling/leasing transactionsPasswordMobile transaction

The present invention relates to a secured transaction system. In one embodiment, a mobile client device includes a user interface configured to enable a user to select a transaction type and collect a user pin number, a processor configured to generate a secured transaction description using the transaction type and the user pin number, wherein the secured transaction description includes issuer ID, account ID, merchant ID, password, transaction amount, and transaction time stamp, and the processor is further configured to transmit the secured transaction description to a mobile processing agent for processing, and receive a transaction record from the mobile transaction processing agent, and a memory configured to store the transaction record in the mobile client device.

Owner:DAI XIA

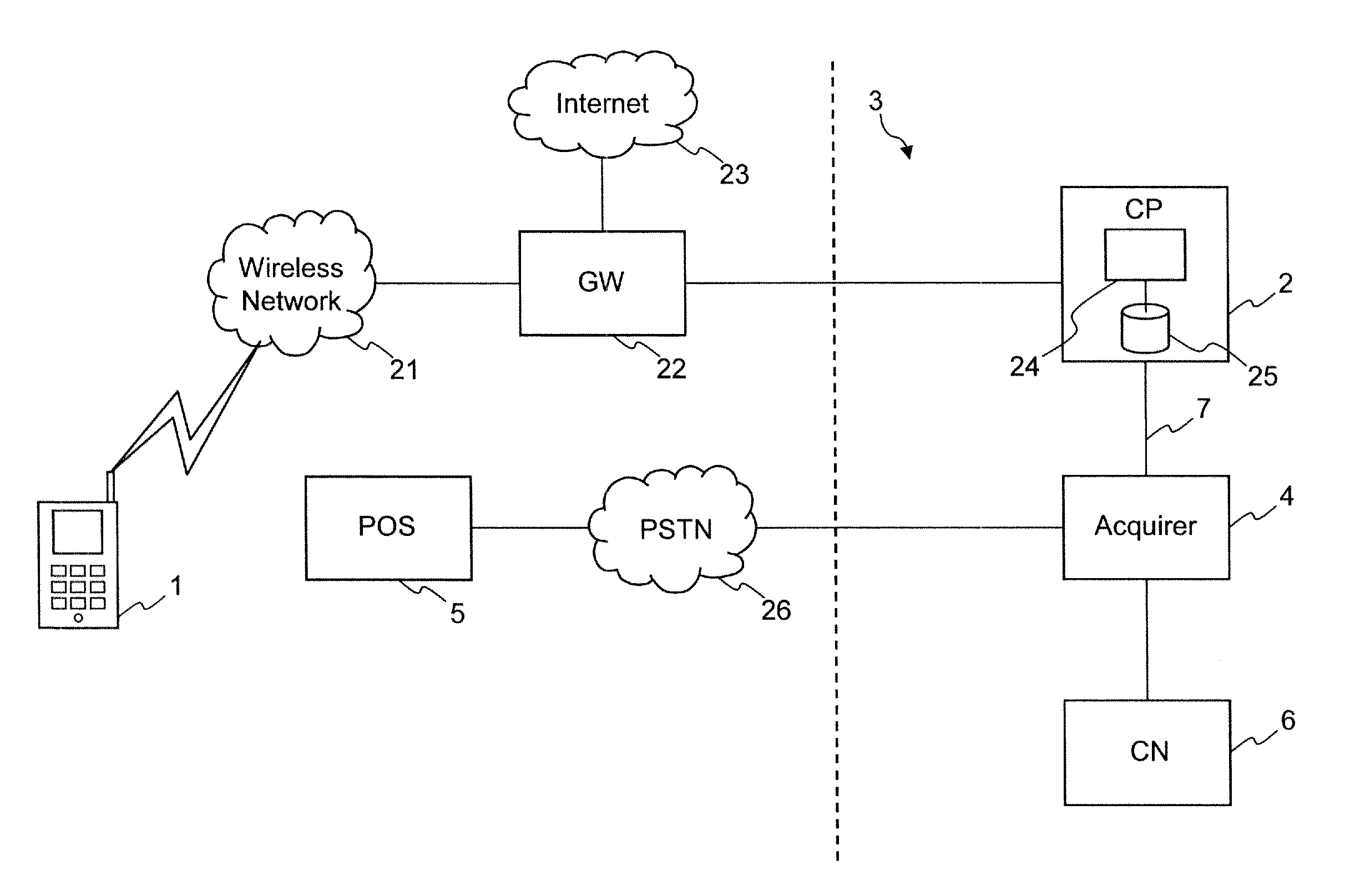

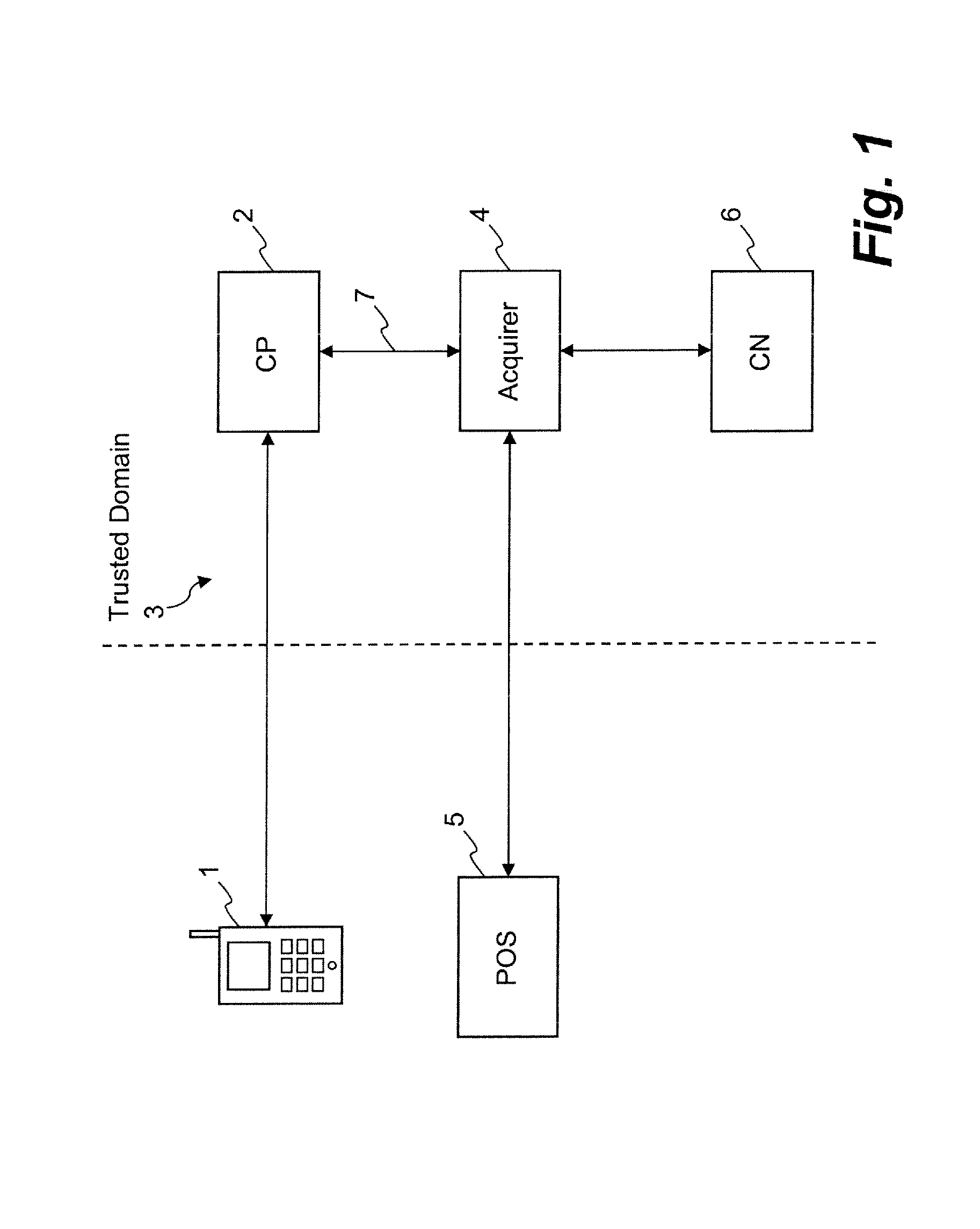

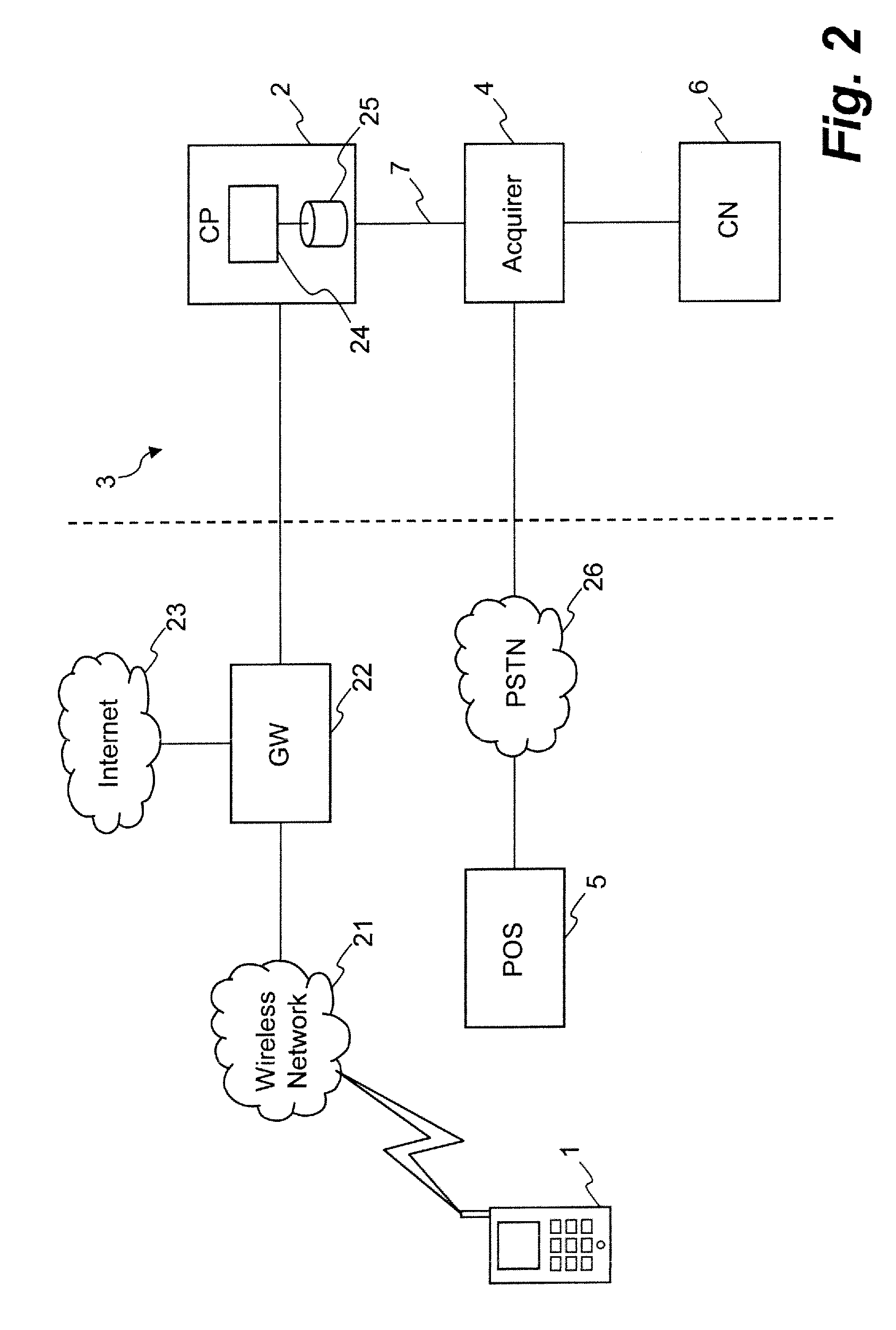

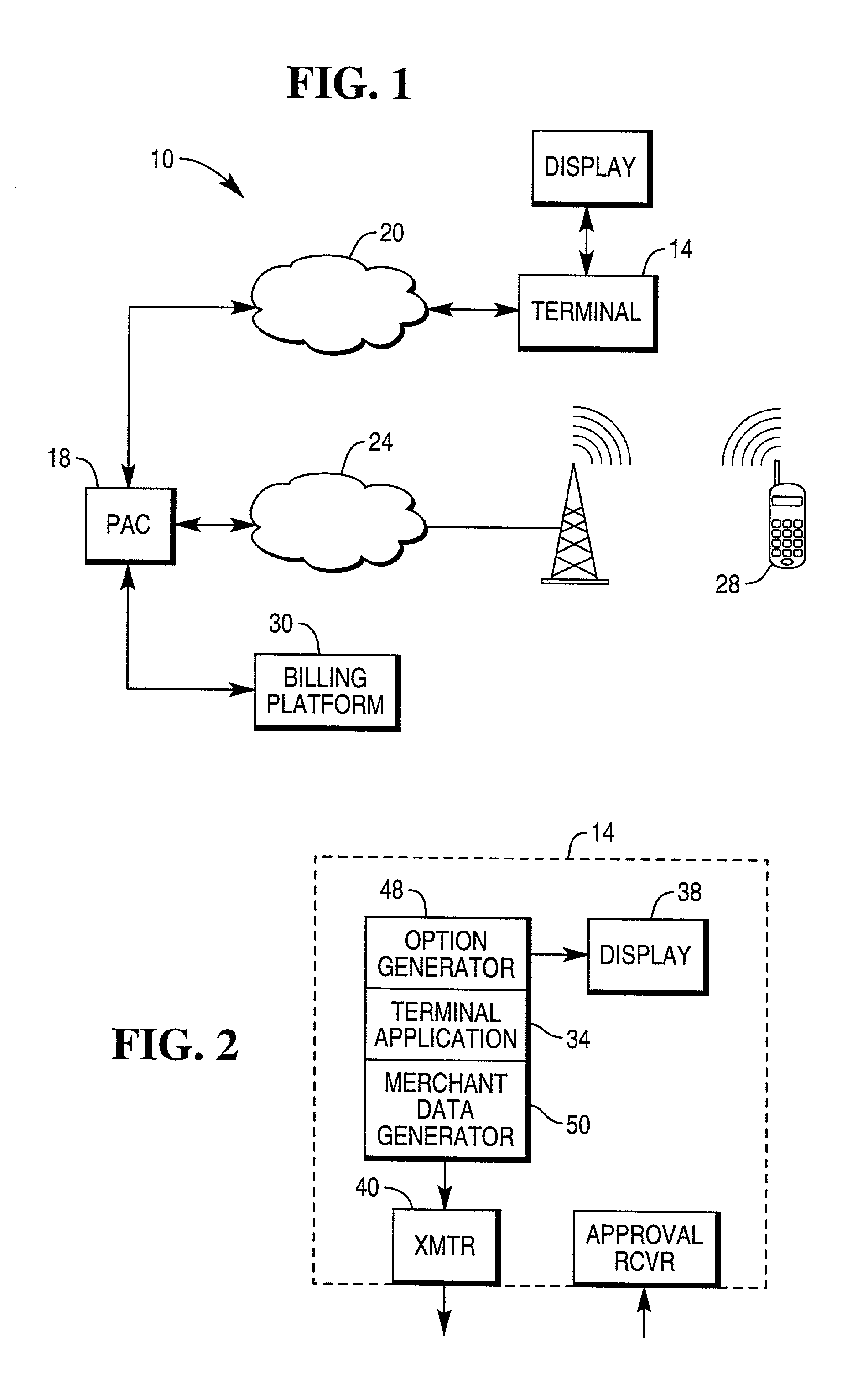

Method and apparatus for performing a credit based transaction between a user of a wireless communications device and a provider of a product or service

A wireless telecommunications carrier operates a commerce platform in a trusted domain, which may store sensitive information associated with a consumer. During a credit card based transaction, a merchant's POS terminal sends transaction information to an acquirer. The acquirer recognizes the transaction type and responds by routing the transaction information to the commerce platform. The commerce platform validates the transaction by verifying the identity of the user. When the transaction is validated, the commerce platform notifies the acquirer, which initiates a clearing process. When the transaction clears, the acquirer notifies the commerce platform and signals the merchant's POS terminal to output a paper receipt. The commerce platform stores a digital receipt of the transaction and signals the wireless device to output a confirmation message to the consumer. The consumer's credit card number and other sensitive information may be restricted to the trusted domain, which excludes the merchant.

Owner:UNWIRED PLANET

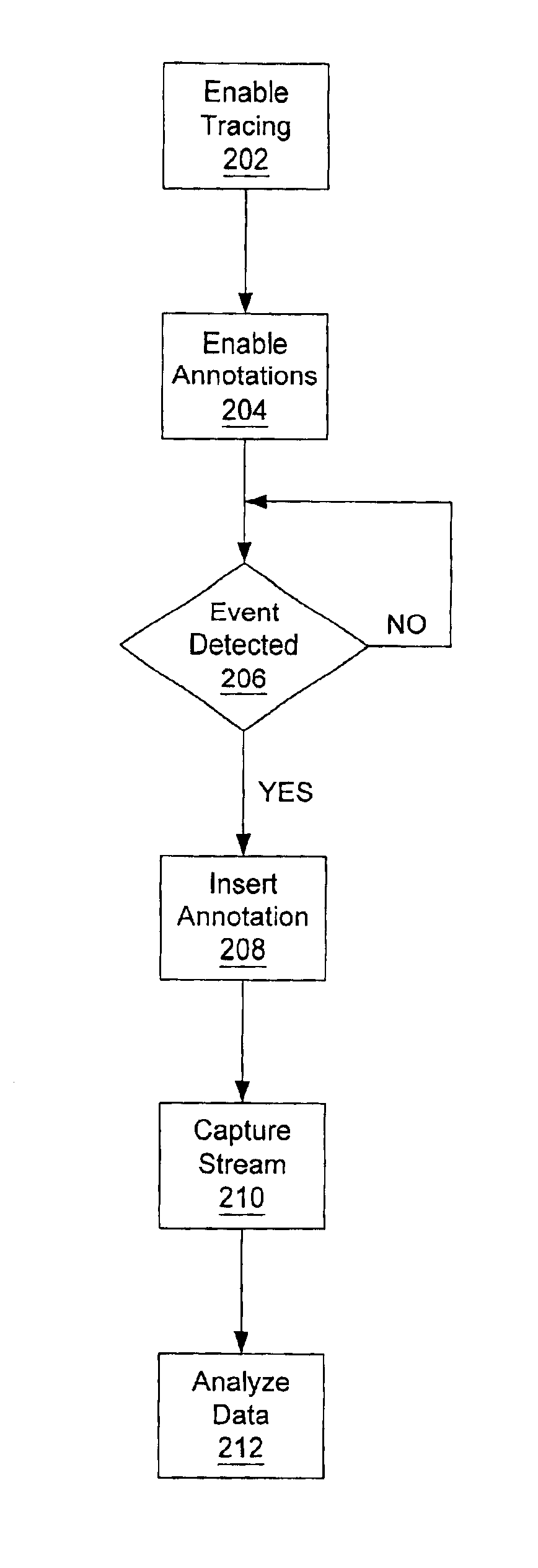

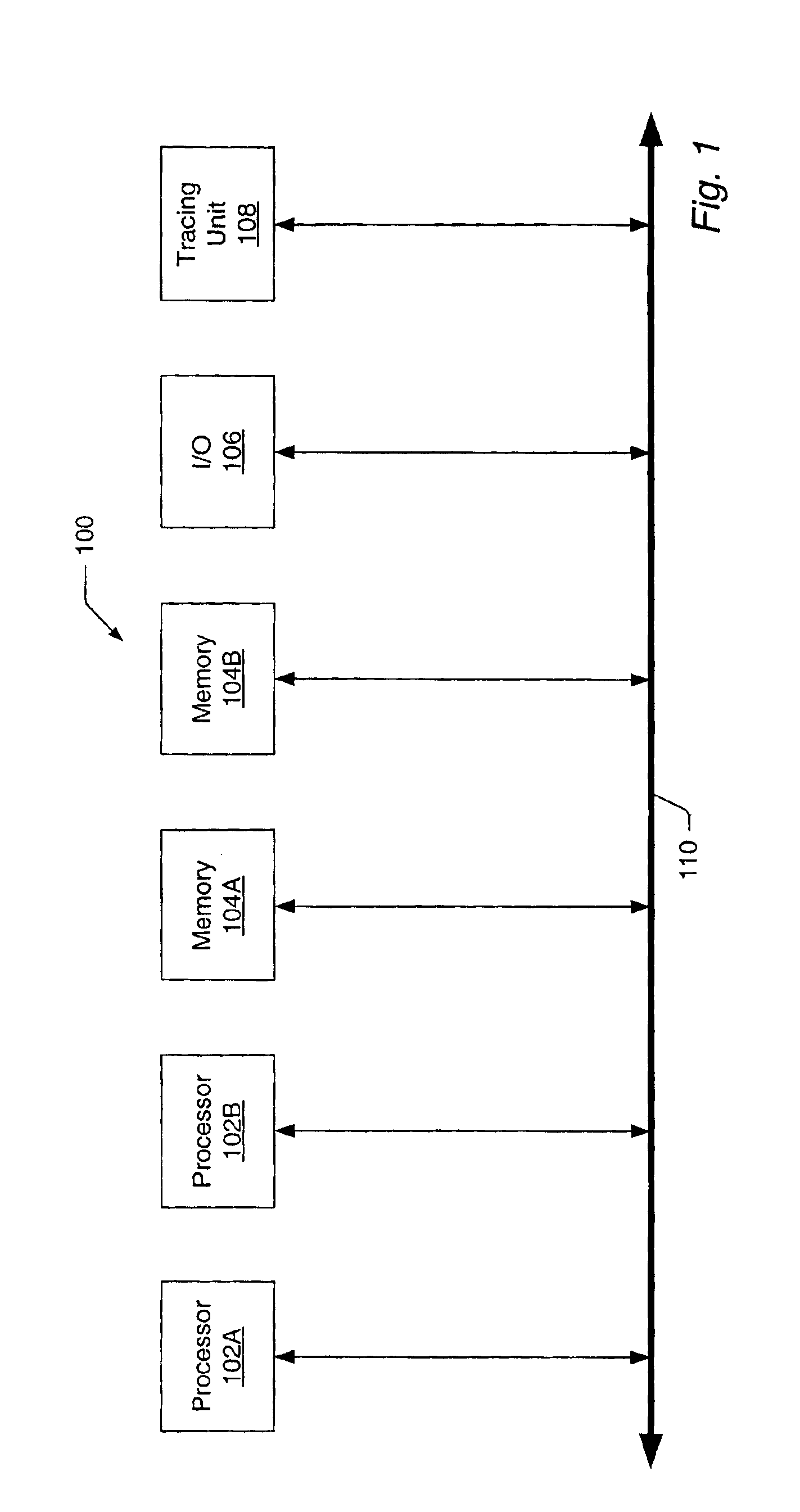

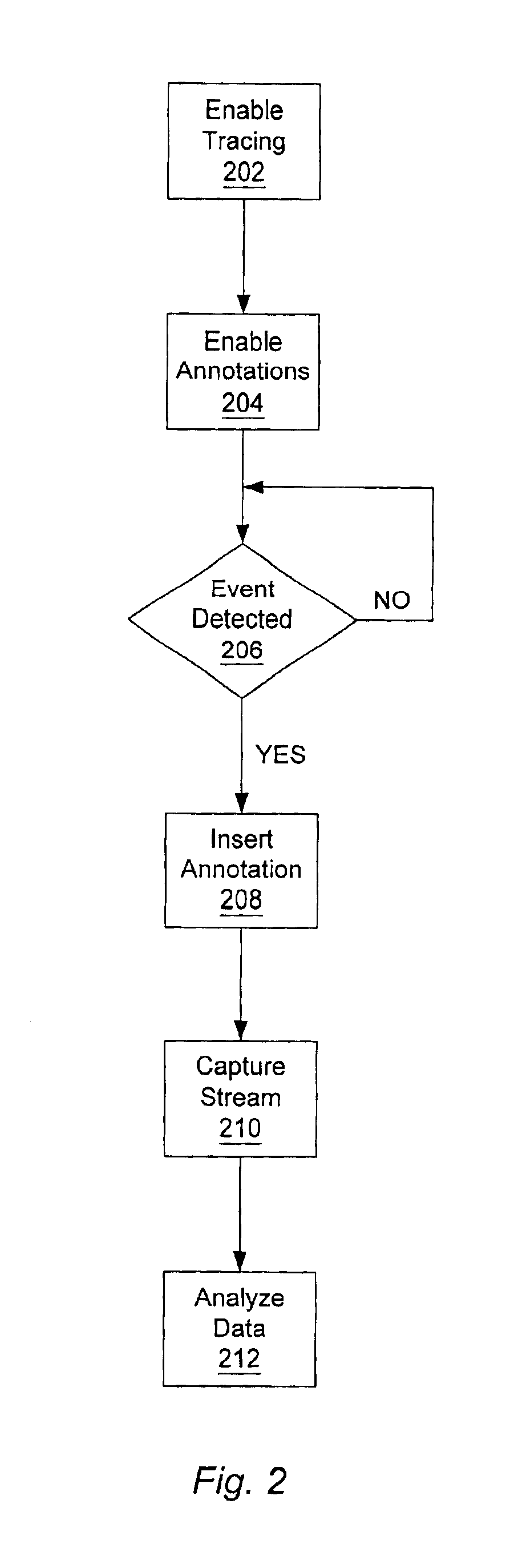

Annotations for transaction tracing

InactiveUS6883162B2Enhanced debugEnhanced performance analysisDigital computer detailsHardware monitoringTimestampOperational system

A method and mechanism for annotating a transaction stream. A processing unit is configured to generate annotation transactions which are inserted into a transaction stream. The transaction stream, including the annotations, are subsequently observed by a trace unit for debug or other analysis. In one embodiment, a processing unit includes a trace address register and an annotation enable bit. The trace address register is configured to store an address corresponding to a trace unit and the enable bit is configured to indicate whether annotation transactions are to be generated. Annotation instructions are added to operating system or user code at locations where annotations are desired. In one embodiment, annotation transactions correspond to transaction types which are not unique to annotation transactions. In one embodiment, an annotation instruction includes a reference to the trace address register which contains the address of the trace unit. Upon detecting the annotation instruction, and detecting annotations are enabled, the processing unit generates an annotation transaction addressed to the trace unit. In one embodiment, annotation transactions may be used to indicate context switches, processor mode changes, timestamps, or address translation information.

Owner:ORACLE INT CORP

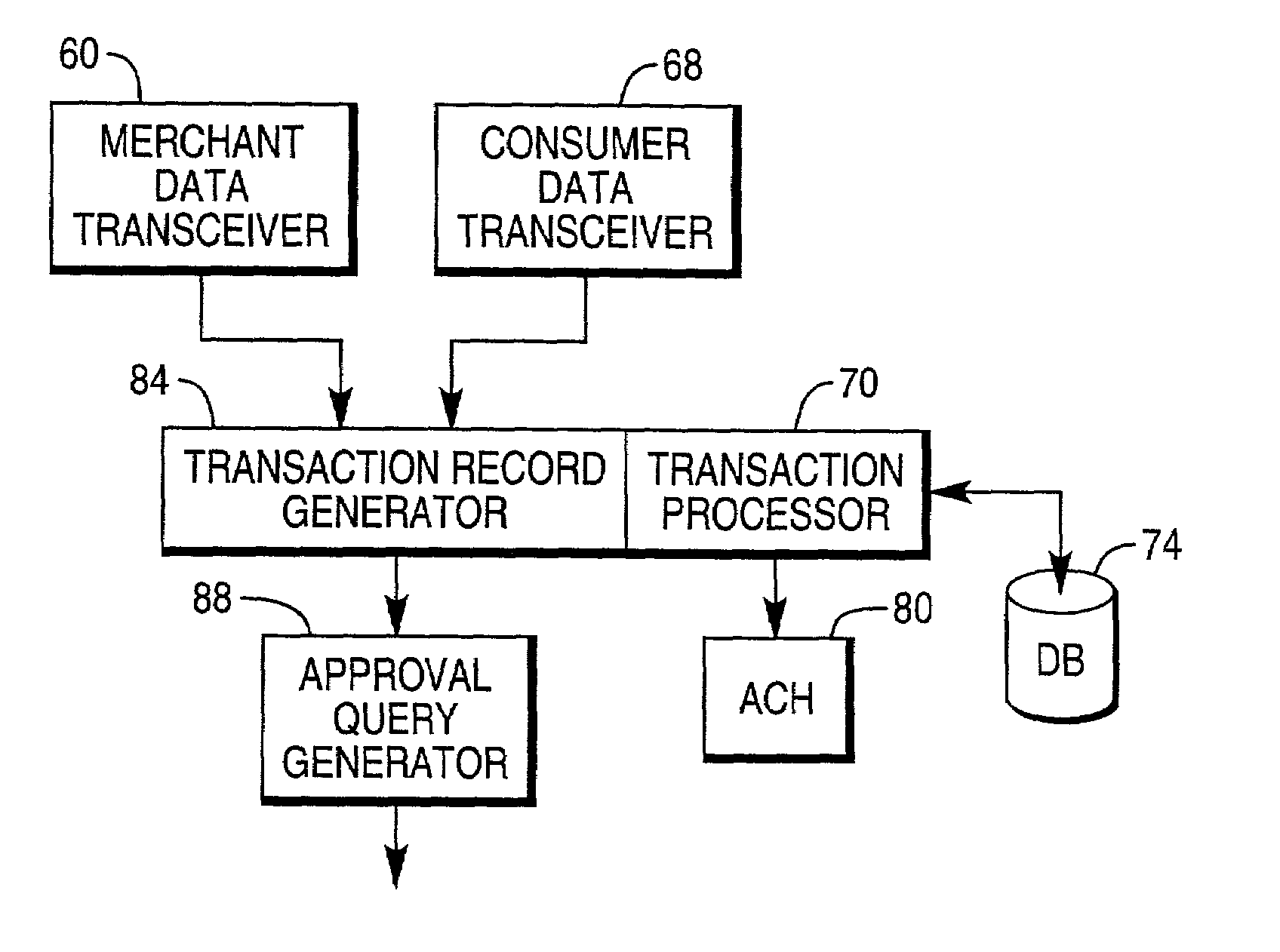

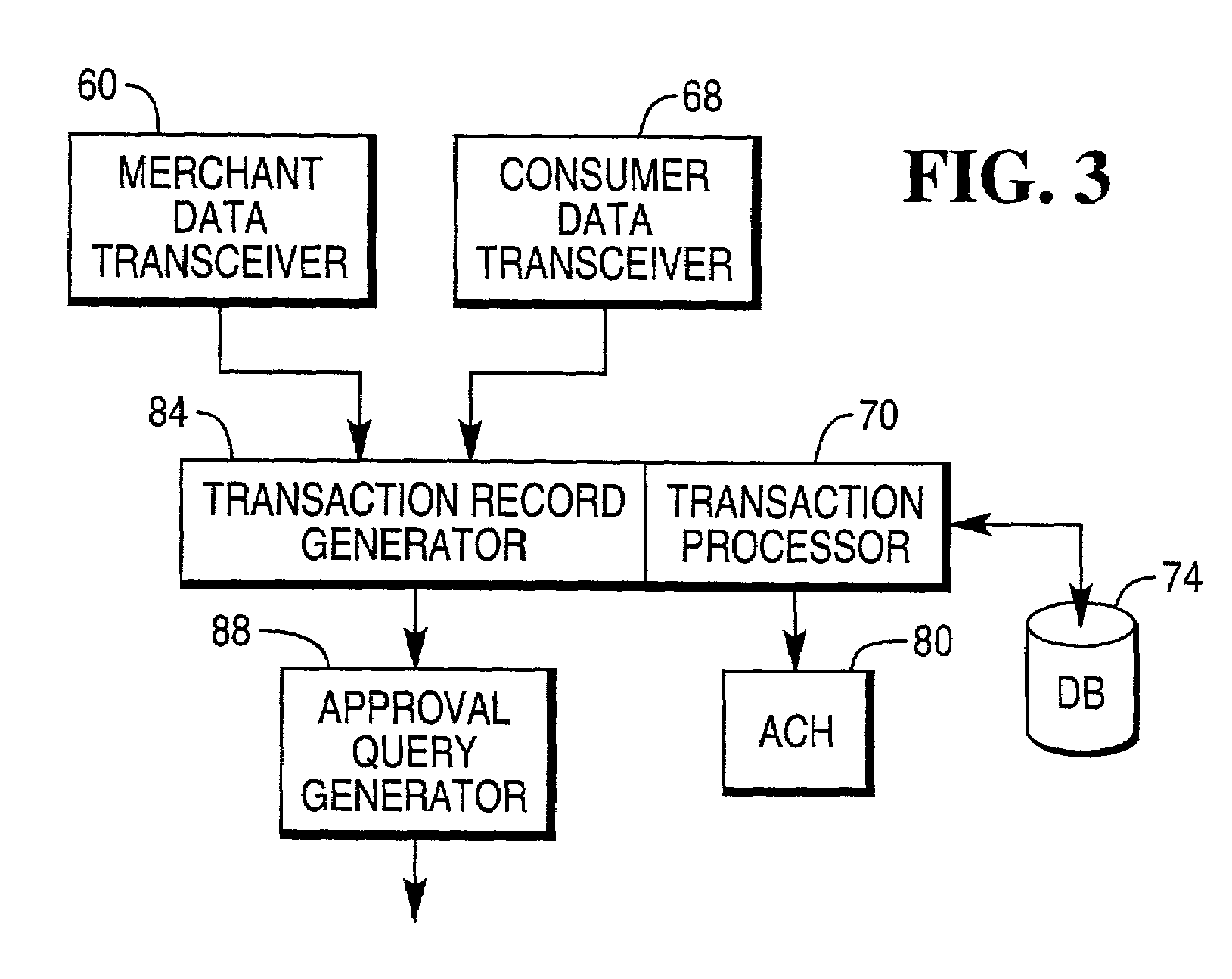

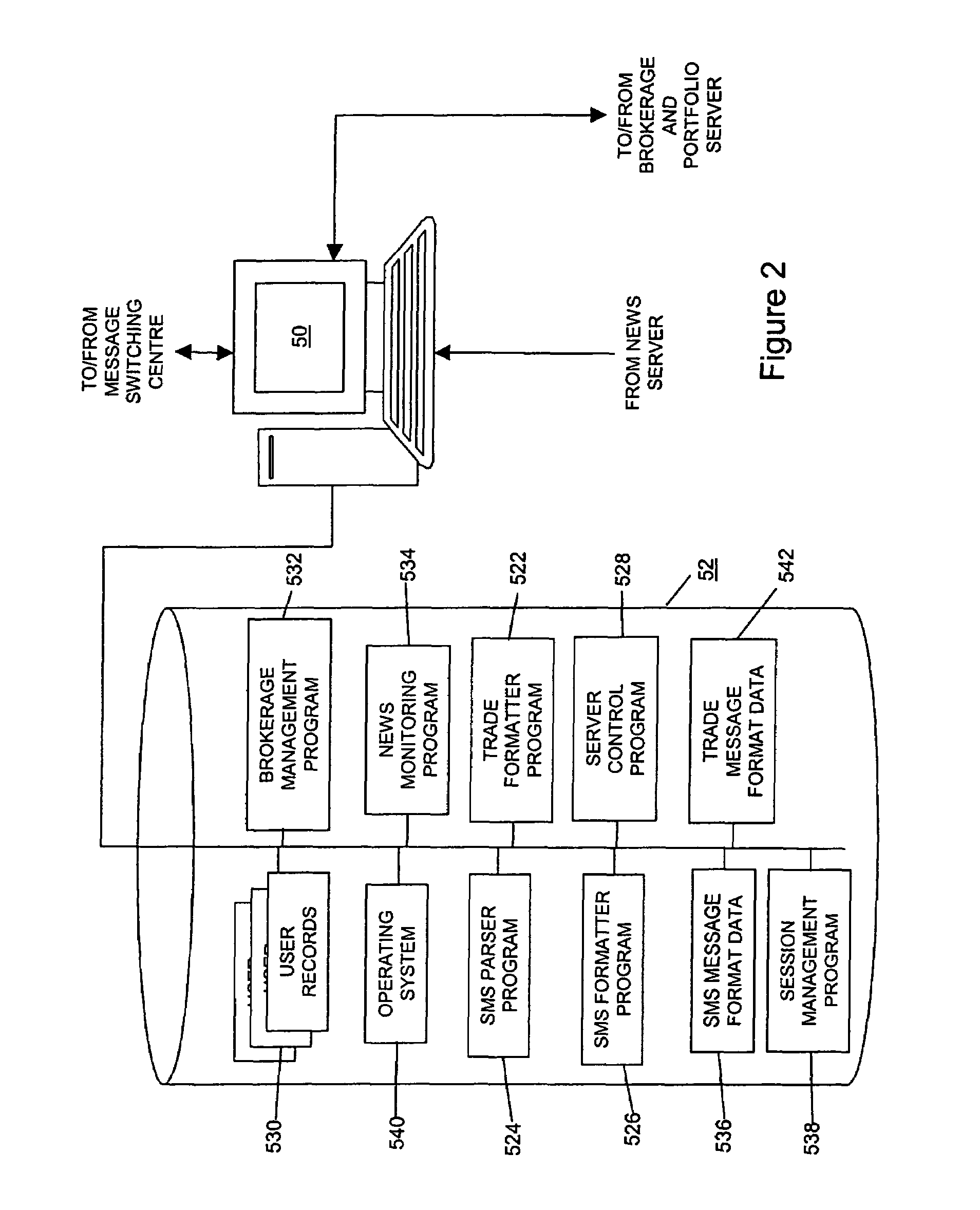

System and method for implementing financial transactions using cellular telephone data

A system and method provide access to a consumer's financial account without requiring a payment service token. The system supports transactions billed to an account associated with a cellular telephone with a merchant terminal for generating and sending merchant transaction data, a consumer data receiver for receiving consumer transaction data from a cellular telephone at the transaction site, and a transaction processor for processing the merchant transaction data and the consumer transaction data to access a financial account. This system is used to verify authorization to access the financial account for payment of a transaction. This system takes advantage of the almost ubiquitous presence of cellular telephones among the consuming public. The merchant terminal operates in a known manner to record data regarding items being purchased by a consumer and generates a total amount for the transaction. The total amount, a transaction code, and a telephone number for payment processing may then be displayed for the consumer. The consumer then uses his or her cellular telephone to call the displayed number and enter the transaction code. Substantially simultaneously with the display of this data, the merchant terminal sends merchant transaction data to the payment processing site. The consumer transaction data and the merchant transaction data are used to generate a transaction record and query a payment service for approval. The approval code may then be returned to the merchant terminal and consumer for appropriate completion of the transaction.

Owner:NCR CORP

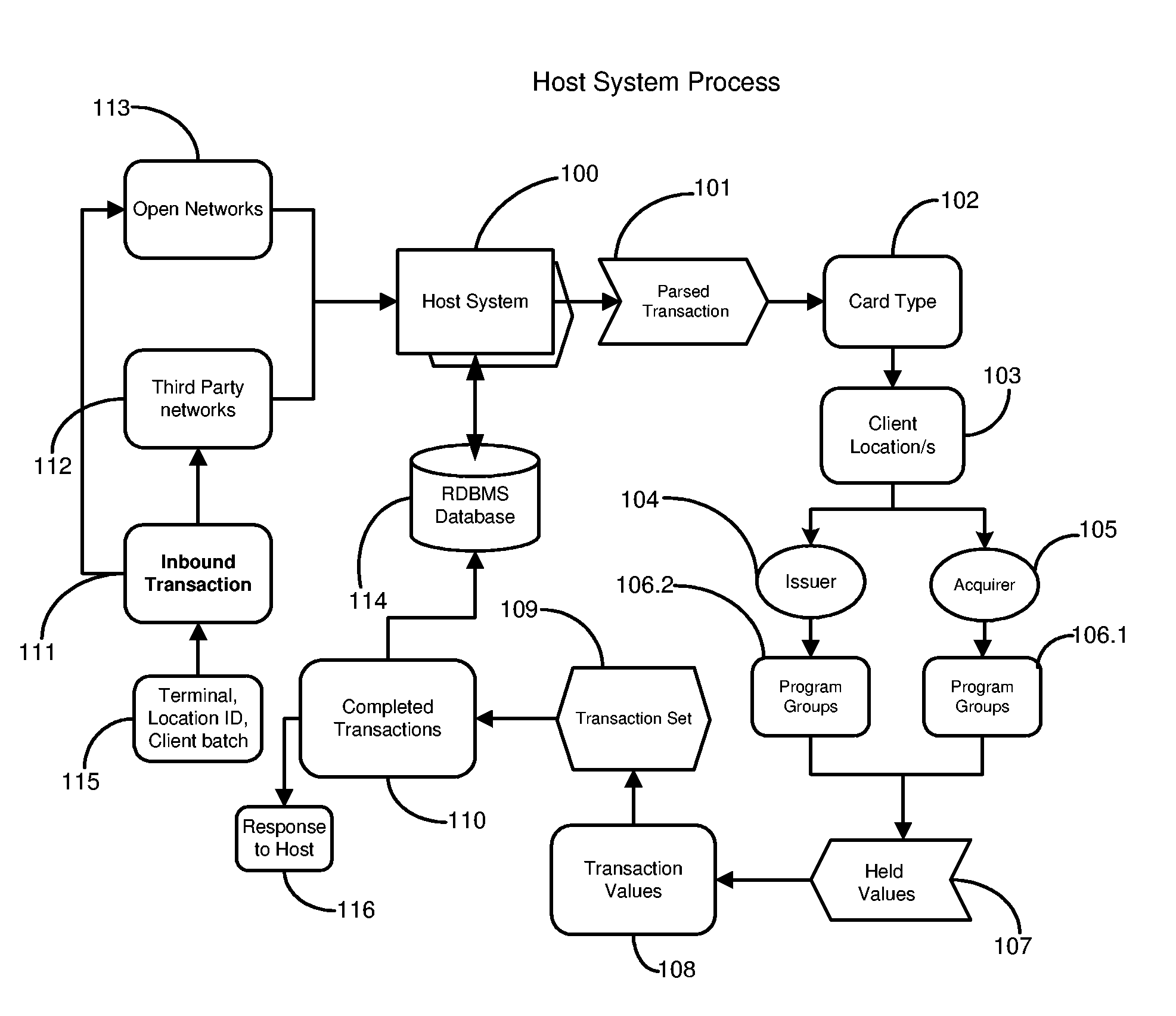

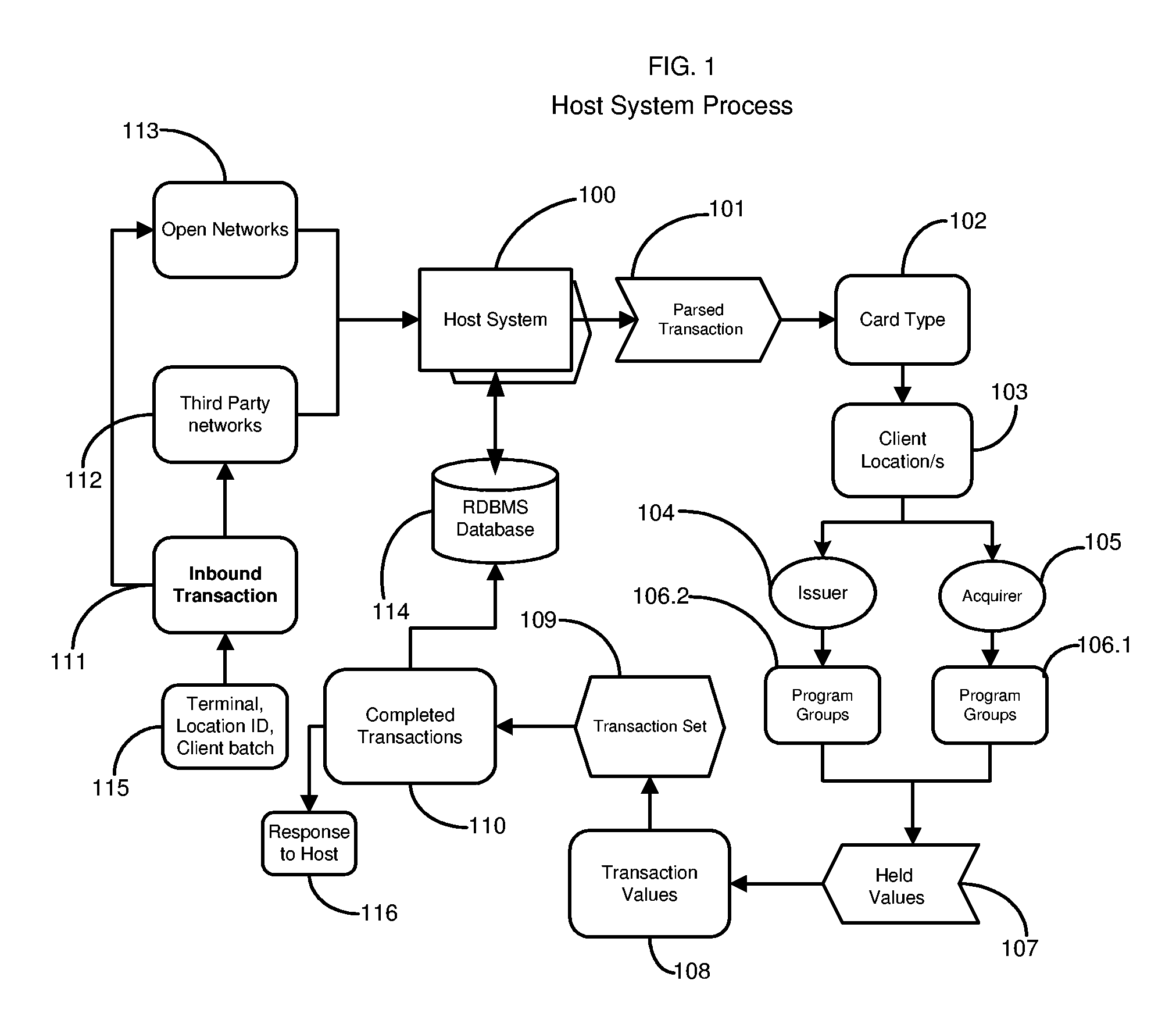

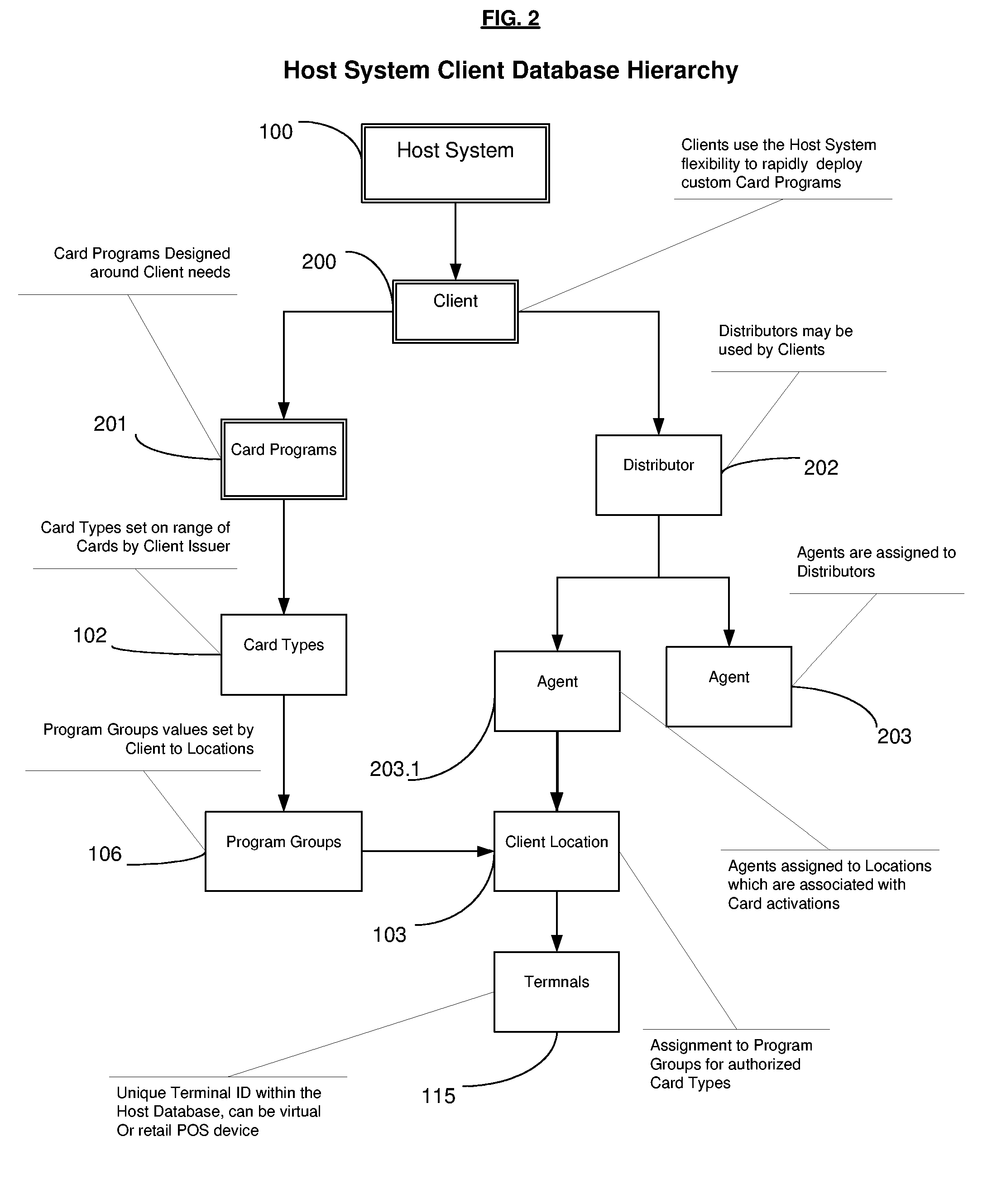

Methods and Systems for Managing Card Programs and Processing Card Transactions

InactiveUS20060026073A1Reduce disadvantagesImproved depth and scope and flexibilityPayment circuitsPoint-of-sale network systemsComputer hardwareTransaction processing

Methods and systems are provided for processing Card transactions. The Cards and Card Programs are configured on a Host System by a Client and transactions are received at a Host System. Issuers of Cards and their Program Groups are configured on the Host System. Acquirers of Card transactions and their Program Groups are configured on the Host System. An Issuer and Acquirer associated with singular Card transactions may or may not belong to the same Client. The Card transactions carry associated data relevant to the Card Type and transaction type captured and identified by the Host System for proper Transaction Set build and ultimate Card transaction processing based on the relevant Issuer and Acquirer set choices. A Web Interface is provided for Clients, their designees, and Cardholders.

Owner:KENNY EDWIN R JR +1

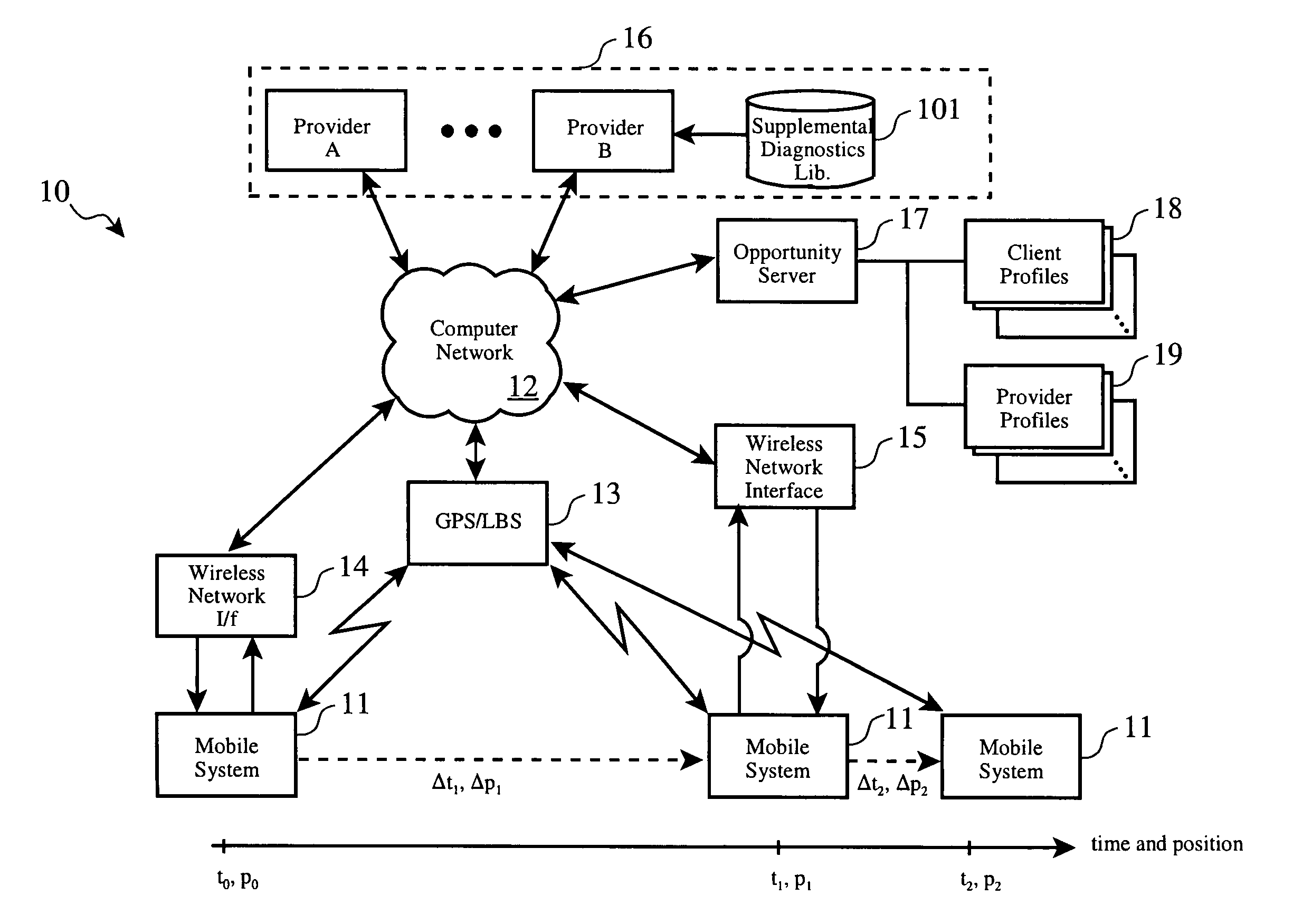

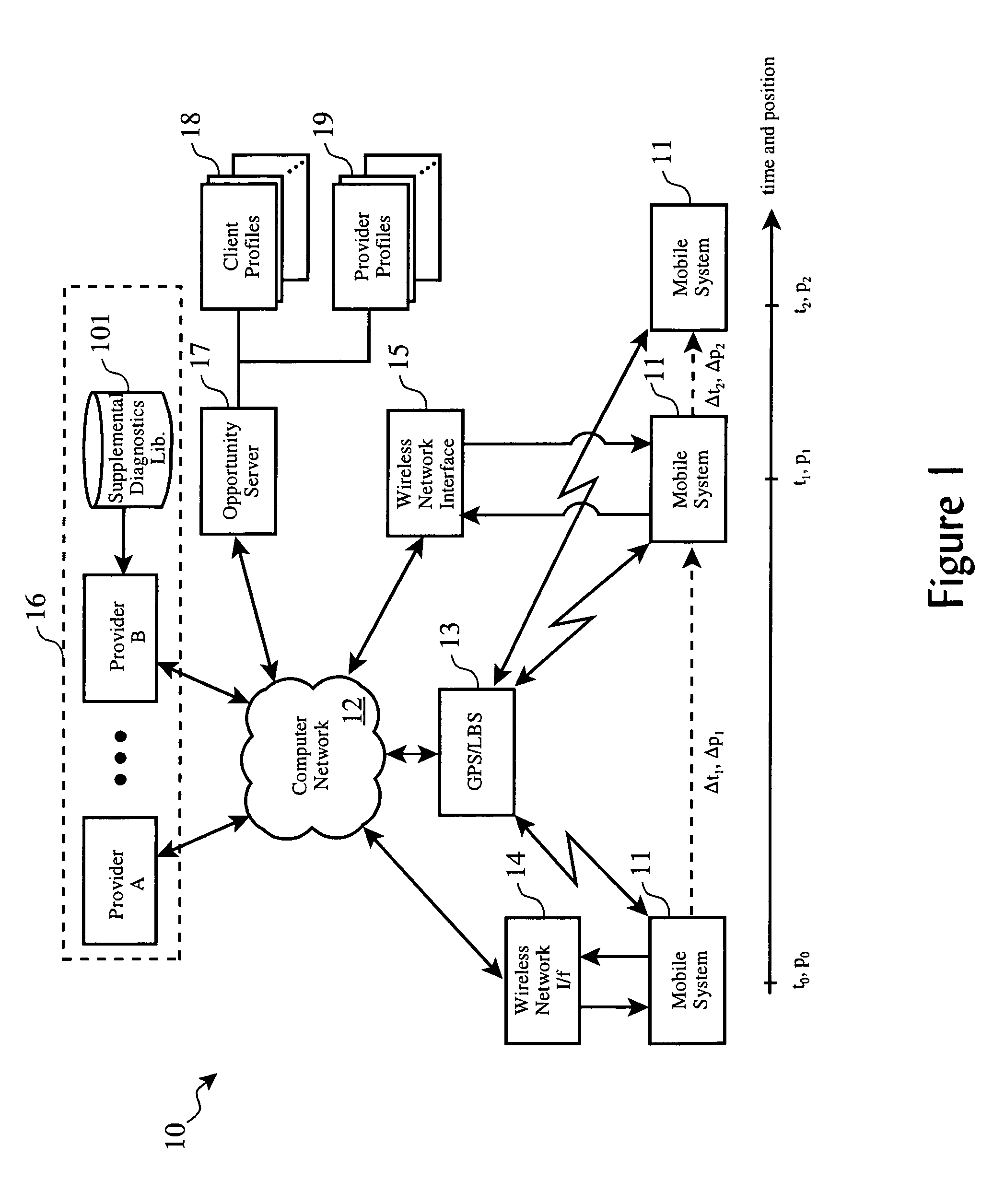

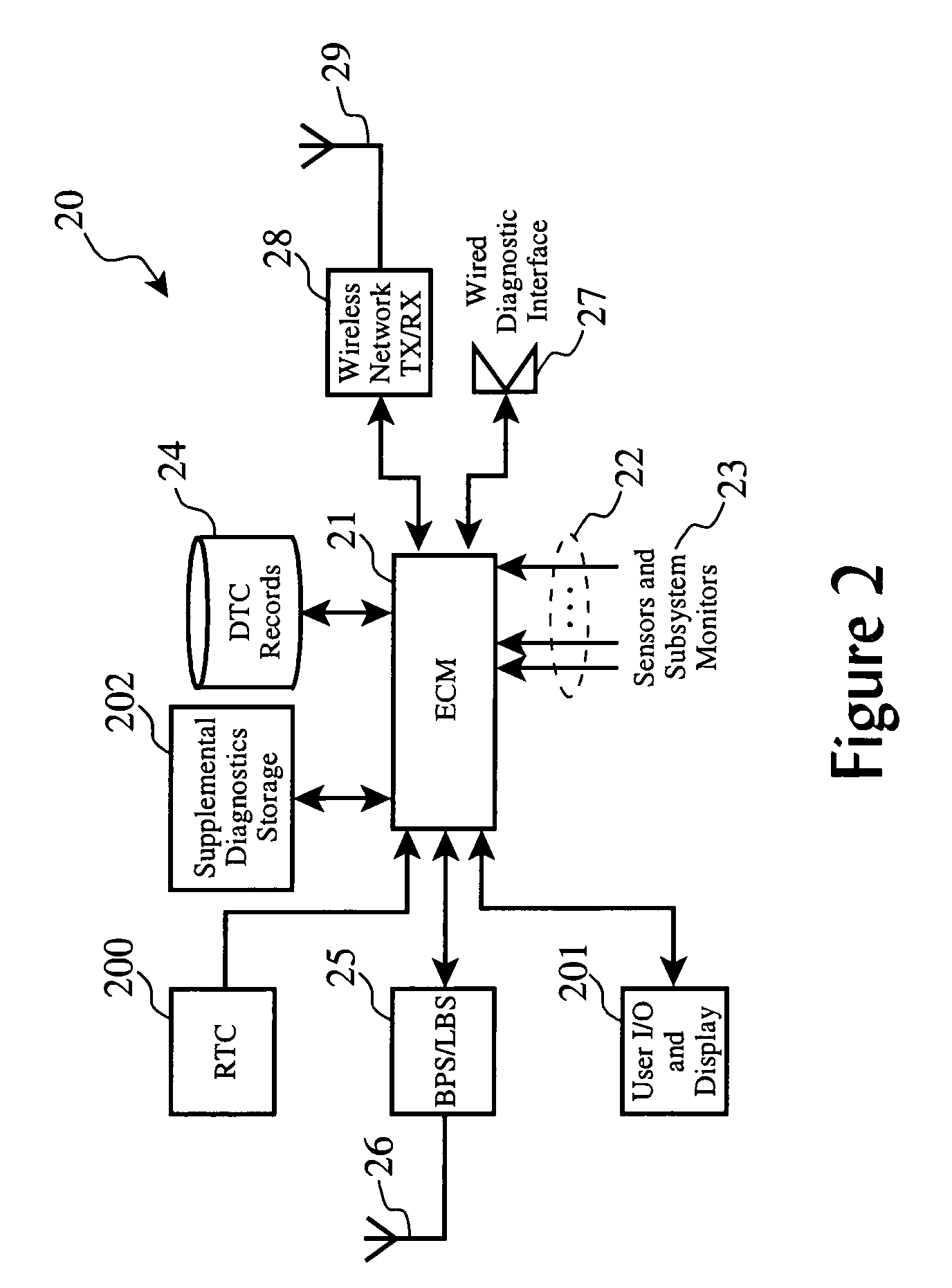

On-demand supplemental diagnostic and service resource planning for mobile systems

Owner:SLINGSHOT IOT LLC

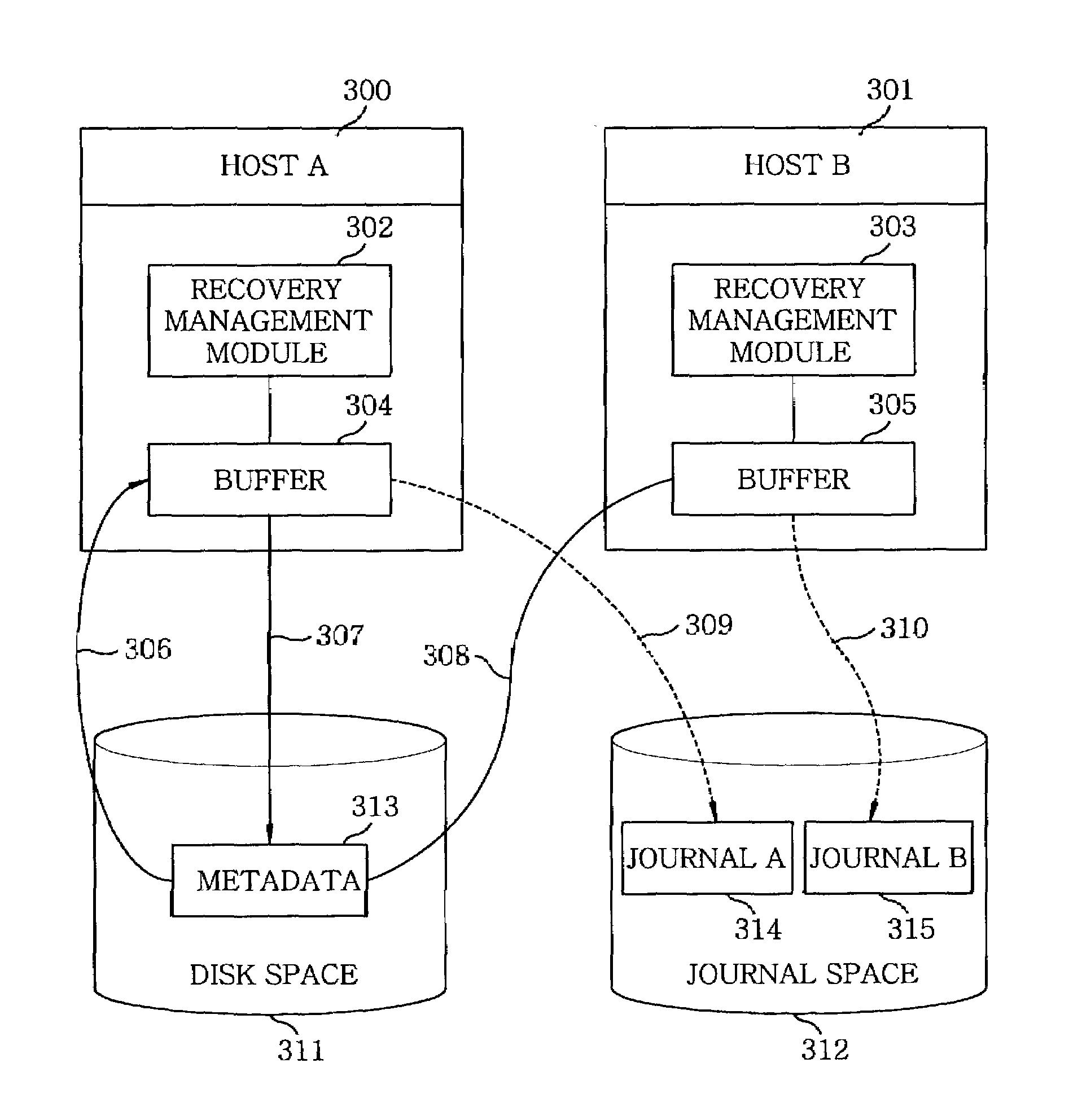

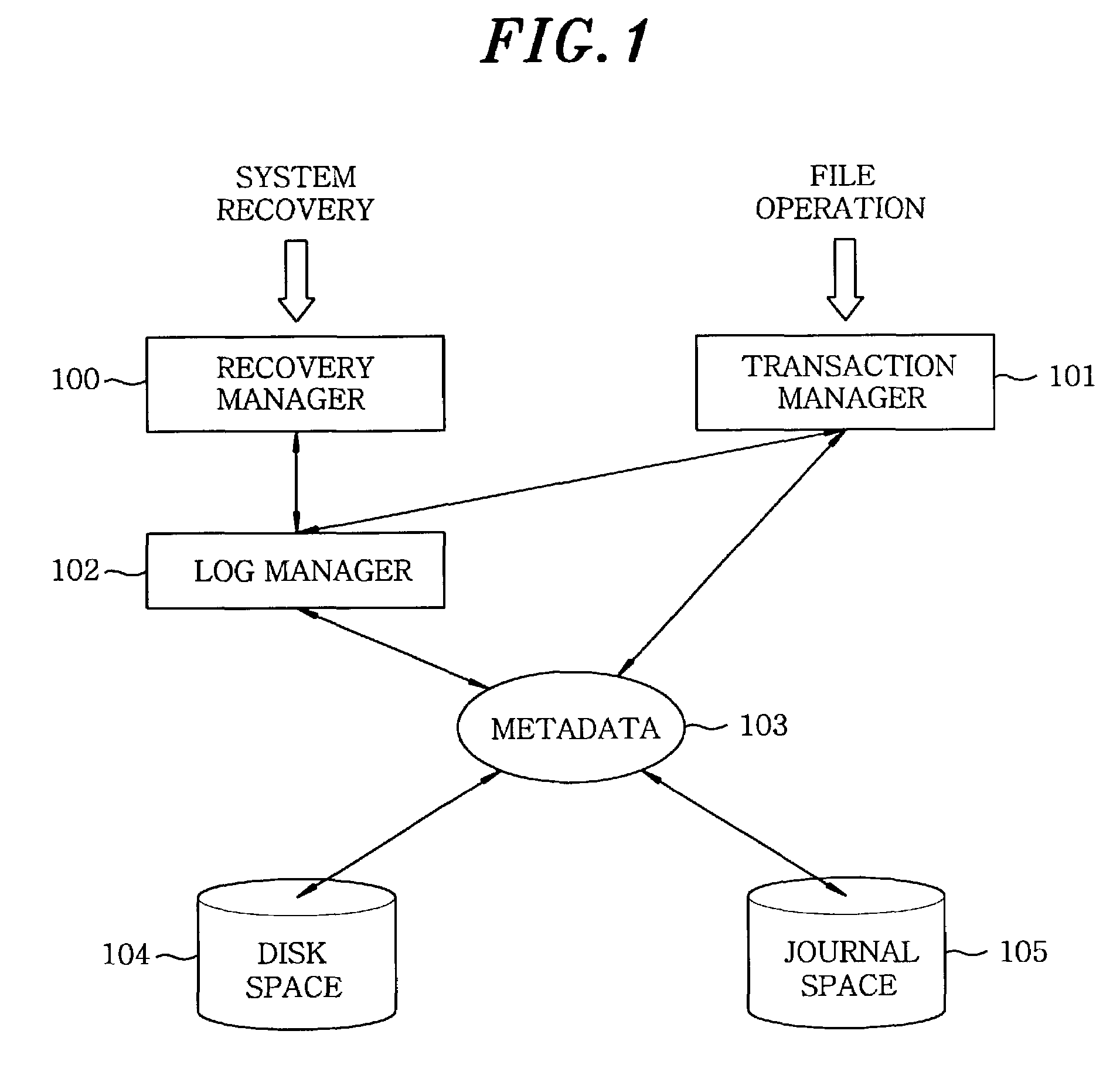

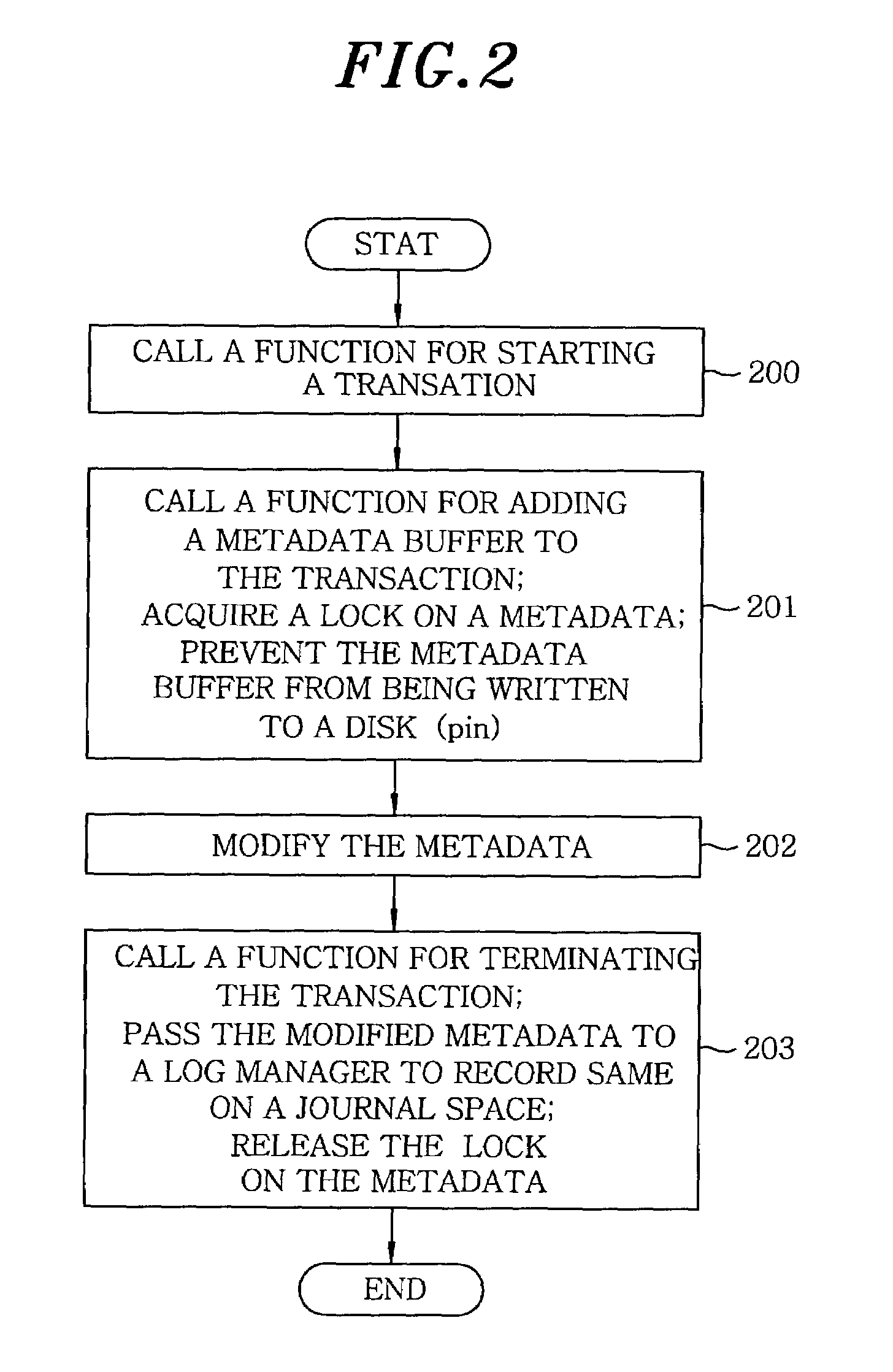

Journaling and recovery method of shared disk file system

ActiveUS7139927B2Increase journaling speedIncrease speedError detection/correctionMultiple digital computer combinationsTransaction TypeMetadata

A journaling method is provided for supporting a recovery when a system is abnormally terminated in a shared disk environment. When a system call operation to take part in a journaling is generated, in order to guarantee a recovery, a transaction is started and new transaction region is assigned. Then, a system is initialized and a transaction type is set up. Lock information on modified data is acquired and added to the transaction so that a transaction manages lock information. A reflection to a disk during a modification of metadata is prevented. Modified metadata added to the transaction and modified information on principal general data are recorded. Then, lock information connected to the transaction is released.

Owner:WISCONSIN ALUMNI RES FOUND +1

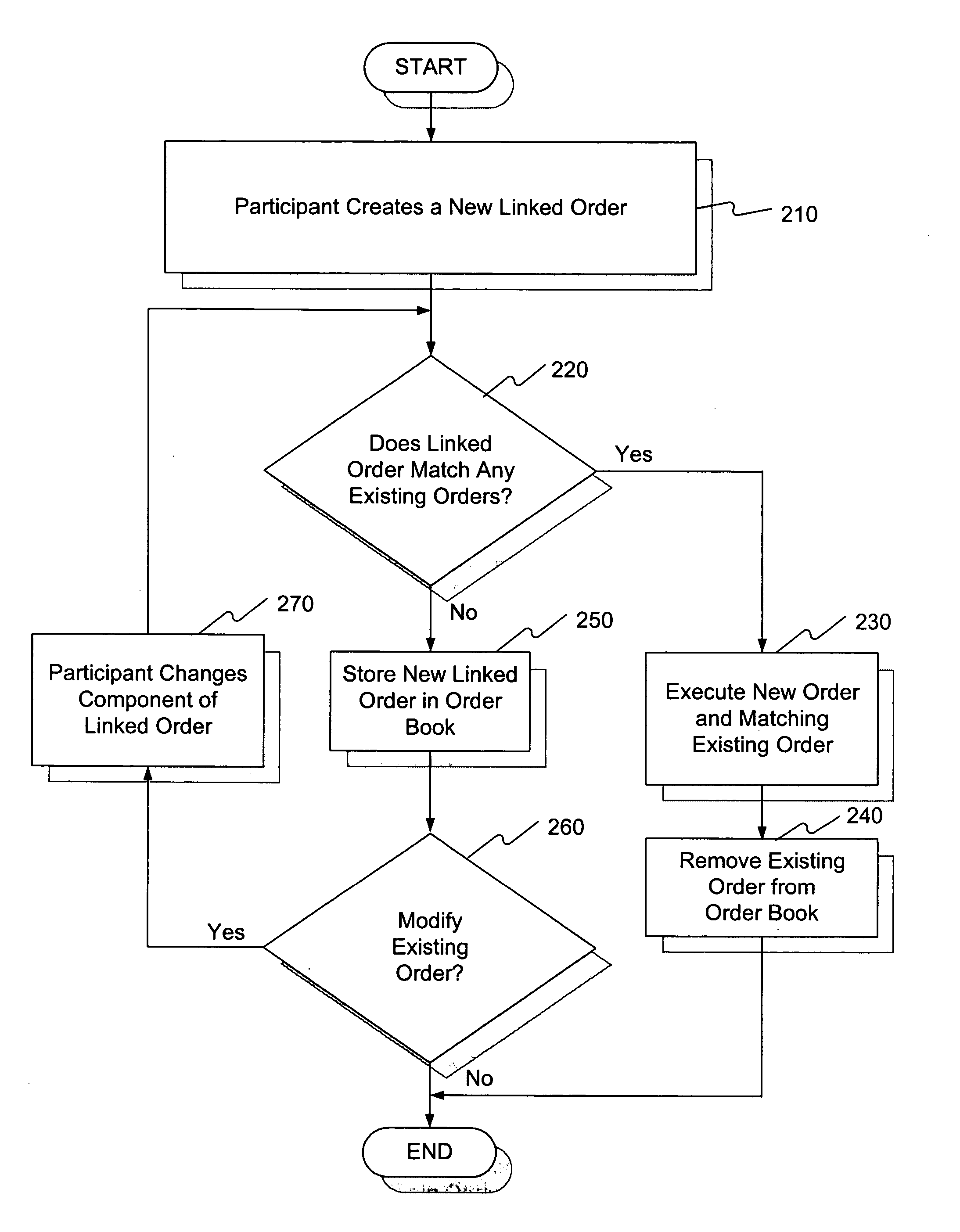

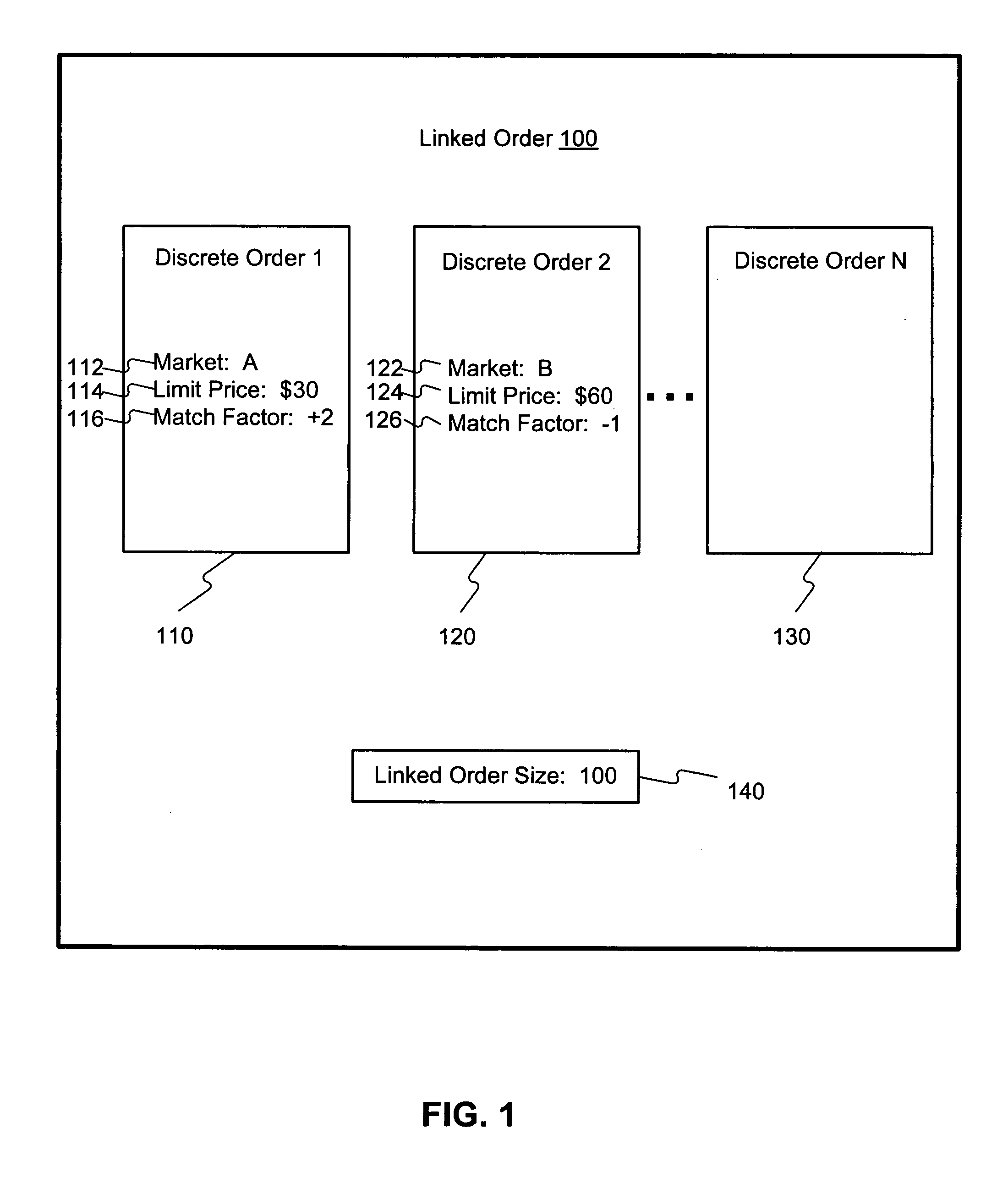

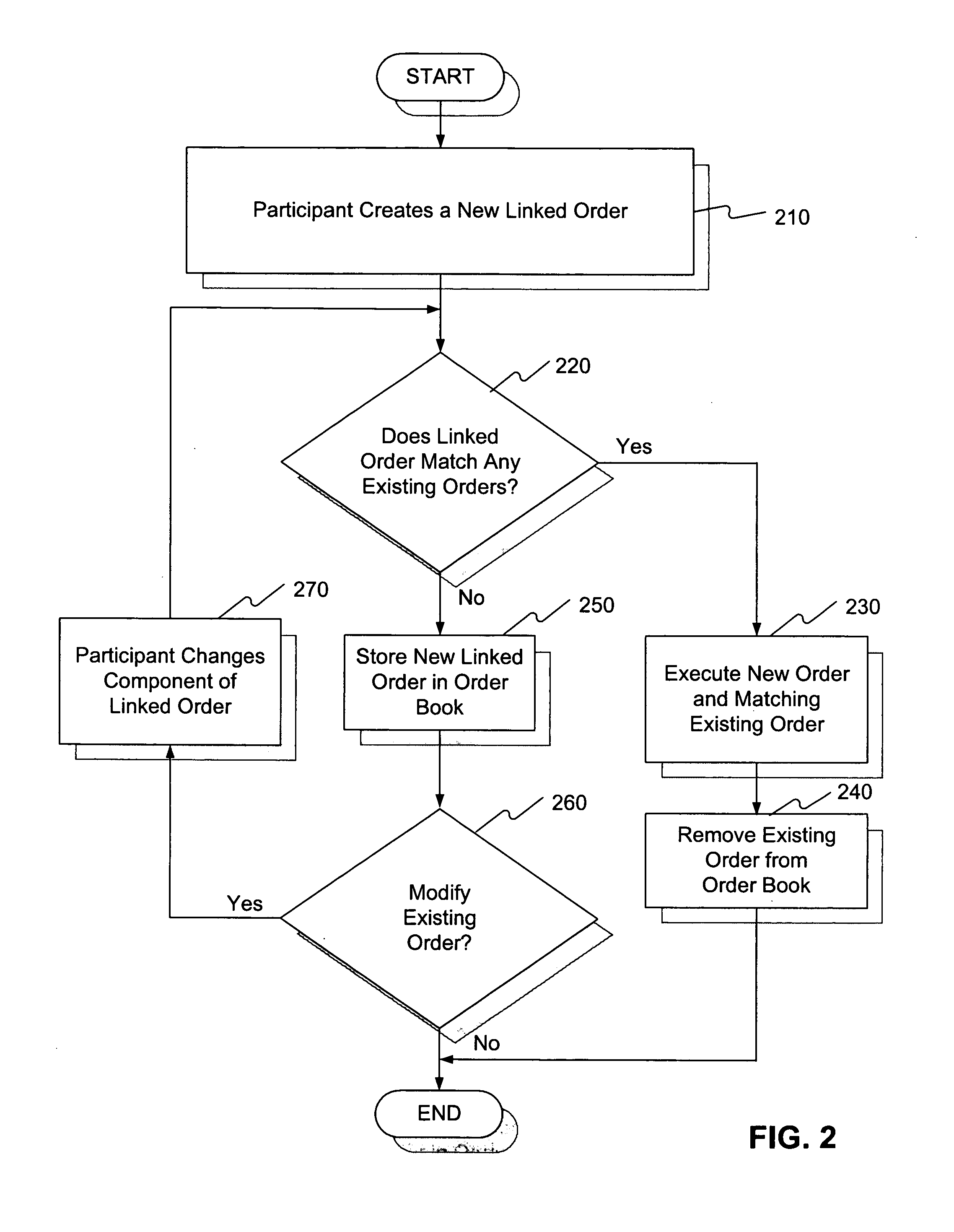

Systems and methods for processing multiple contingent transactions

InactiveUS20050125329A1Increase salesFinanceSpecial data processing applicationsSystems approachesComputer science

Owner:PERIMETER FINANCIAL CORP

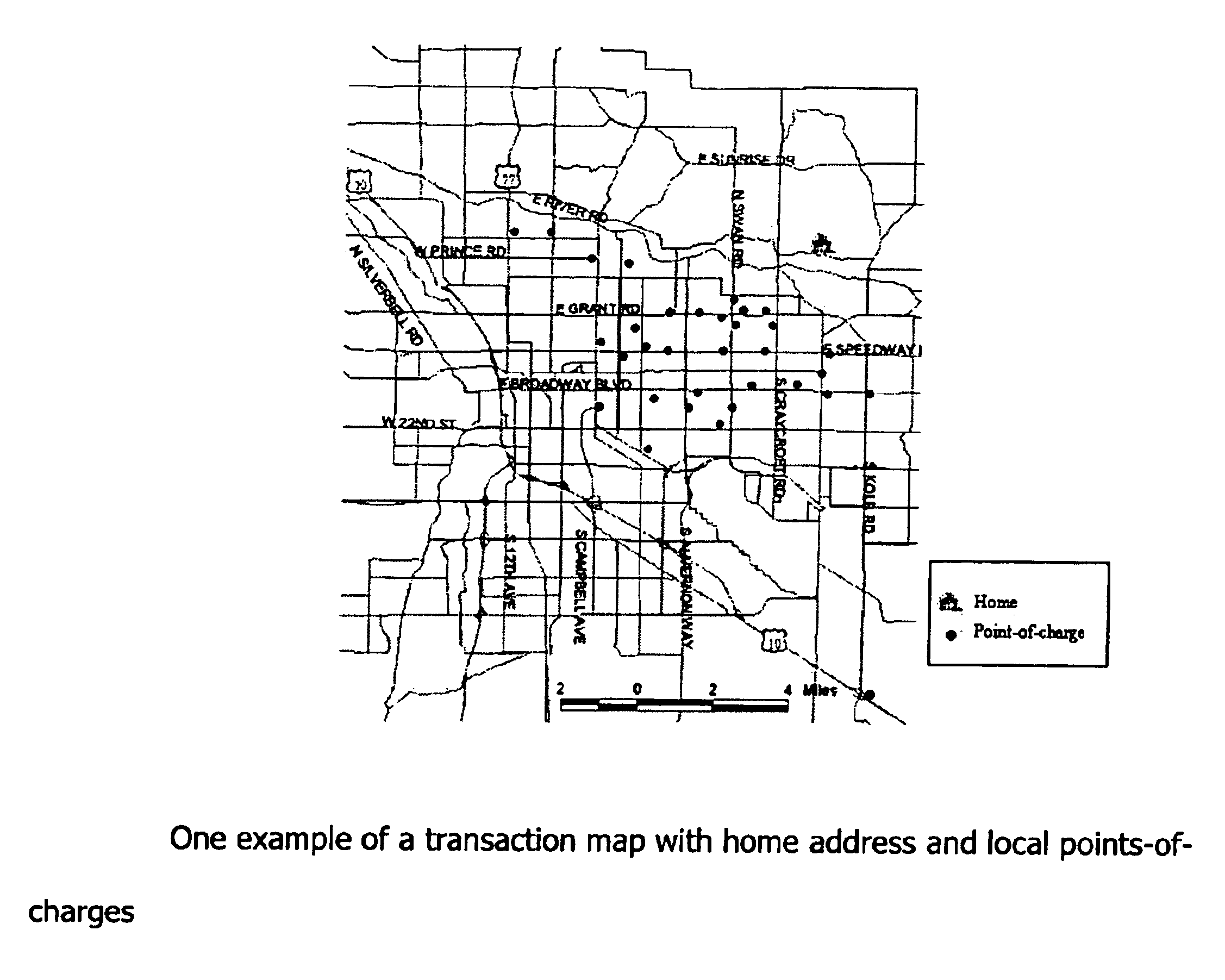

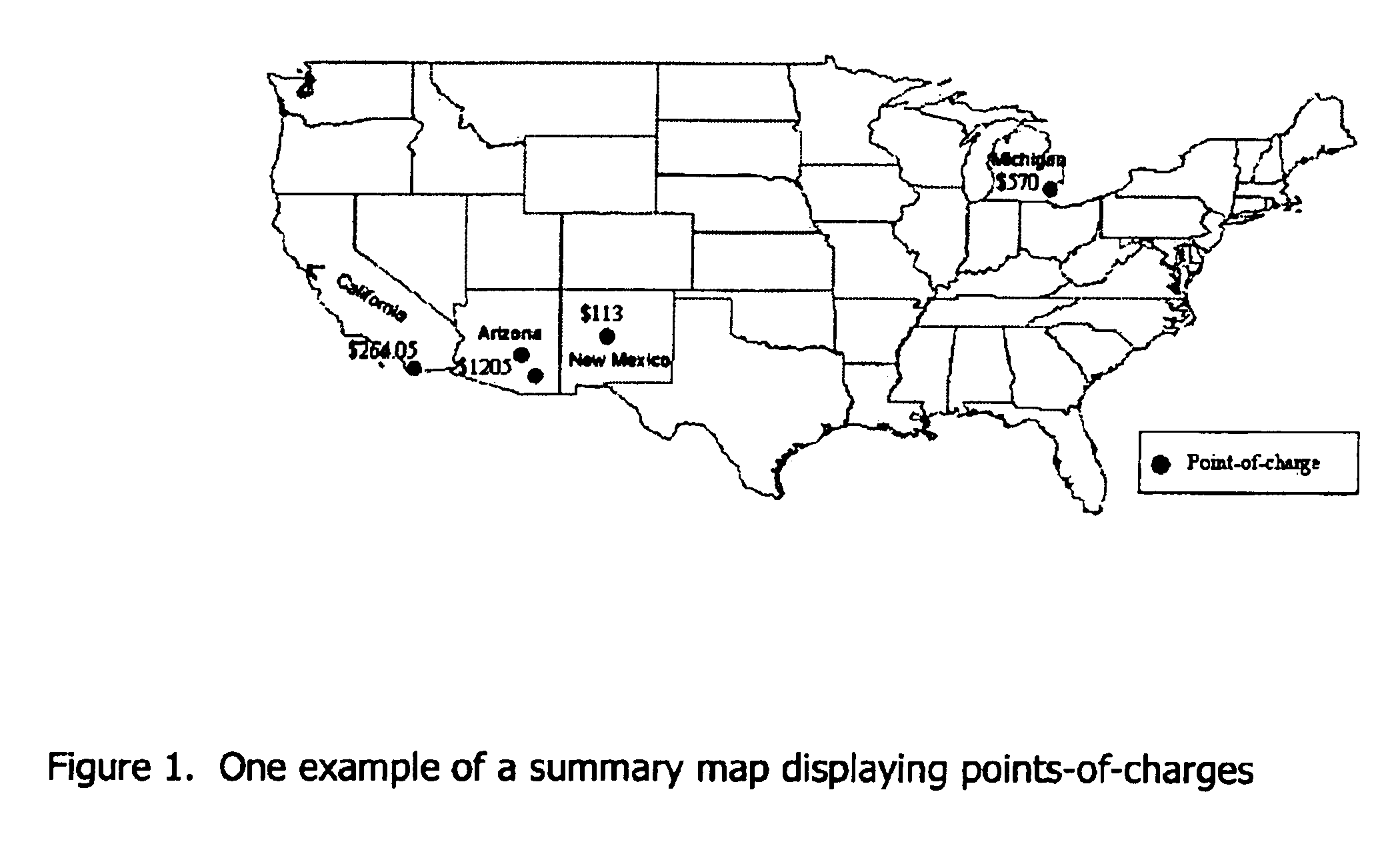

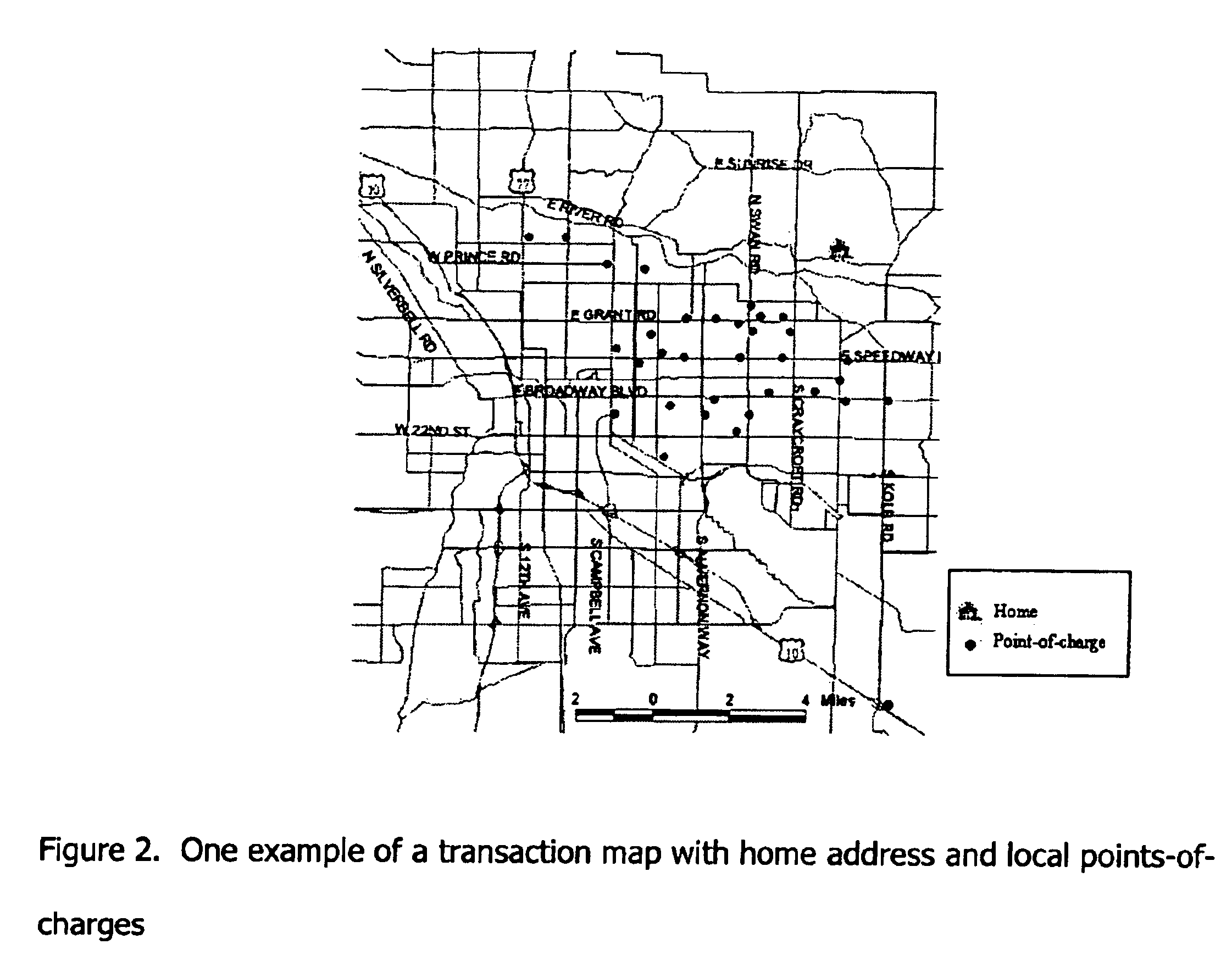

Transaction maps embedded within or provided with charge-card billing statements

InactiveUS6883708B1Improving marketing potentialDifficult to comprehendBilling/invoicingPayment circuitsFinancial transactionRule system

A method and system is described herein to summarize and present charge-card transactions through one or more maps linked to charge-card billing statements. In addition to a conventional tabular transaction list, the invented system provides charge-card transaction maps, which display the physical location of points-of-charges geo-referenced to a map. Transactions are listed individually and / or are summarized by the number of transactions, the timing of transactions, the amount of transactions, the transactions categories, local-area and none-local-area transactions, sensitive transactions, geographic unit, or any combination thereof. The method and system integrates database and geographic information system technology with a rule system.

Owner:FIEDLER RENO +1

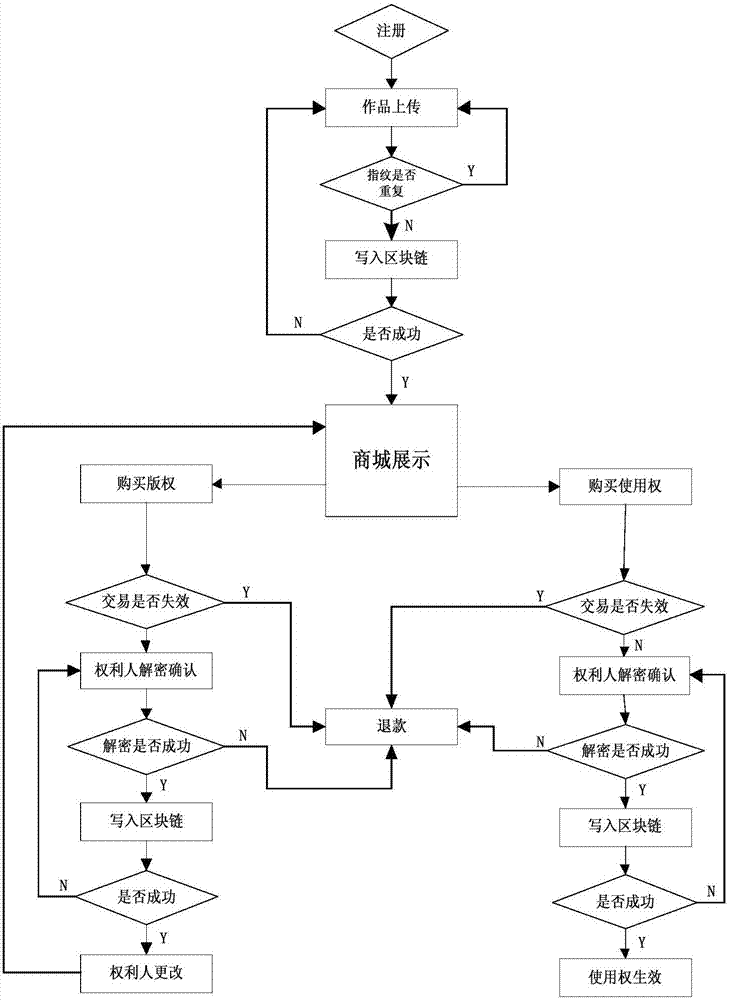

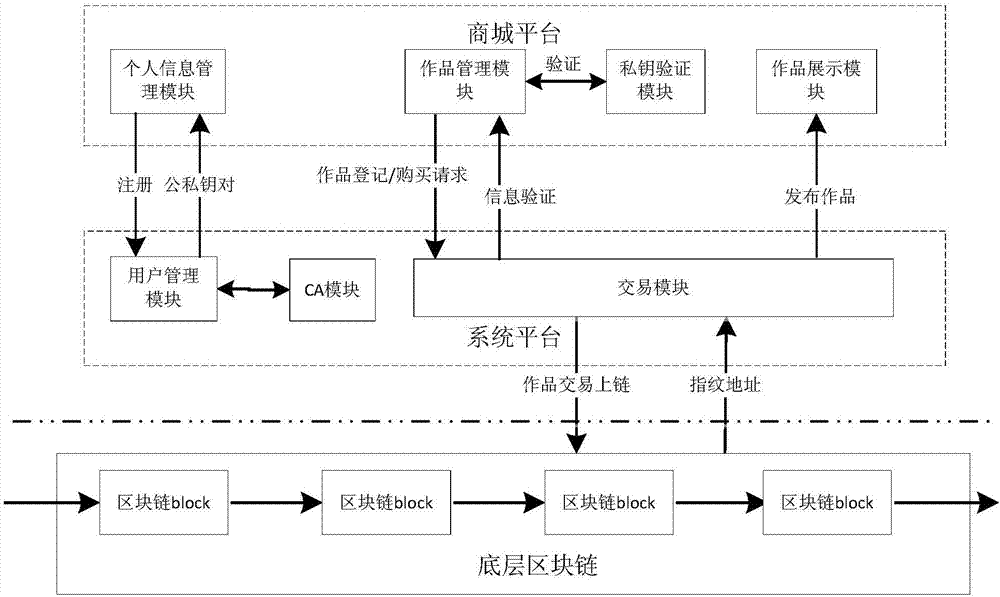

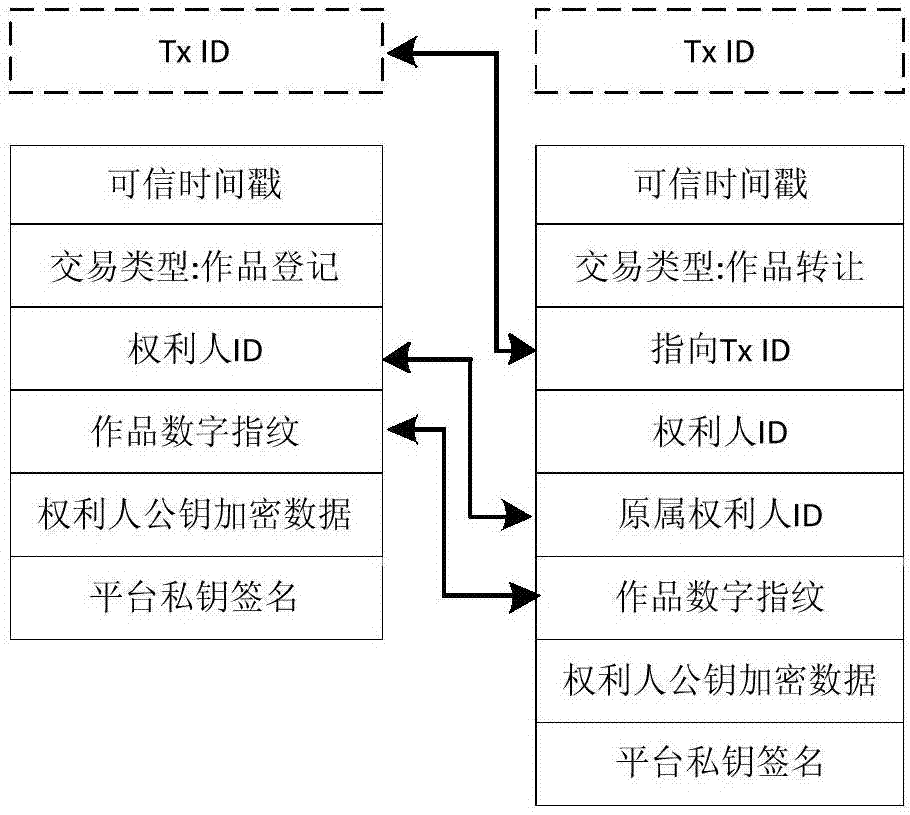

Blockchain-based copyright trading system and trading method

InactiveCN107330694AEliminate secondary transactionsCopyright transactions are open and transparentProtocol authorisationTimestampTransaction data

The invention discloses a blockchain-based copyright trading system and a trading method. The blockchain-based copyright trading method comprises creating the copyright trading system, and the trading system comprises a system platform, a shopping mall platform and bottom blockchains. The method is characterized in that a user is registered as a platform user through the system platform, and the system platform issues a unique public-private key pair and a unique user ID for the platform user; a copyright owner uploads a work to the shopping tall platform, and adds signatures of public and private keys to the work; the shopping mall platform verifies signature information of the copyright owner through the private key, and generates fingerprint information uniquely corresponding to the signature information for the work; and the system platform creates a blockchain transaction, and perform cochain on fingerprint information, copyright owner public key encrypted data, the copyright owner ID, a transaction type, a credible timestamp and the platform private key signature, which are taken as transaction data, at the same time. All transaction details are recorded by utilizing the blockchains, and then copyright trading is very secure.

Owner:重庆小犀智能科技有限公司

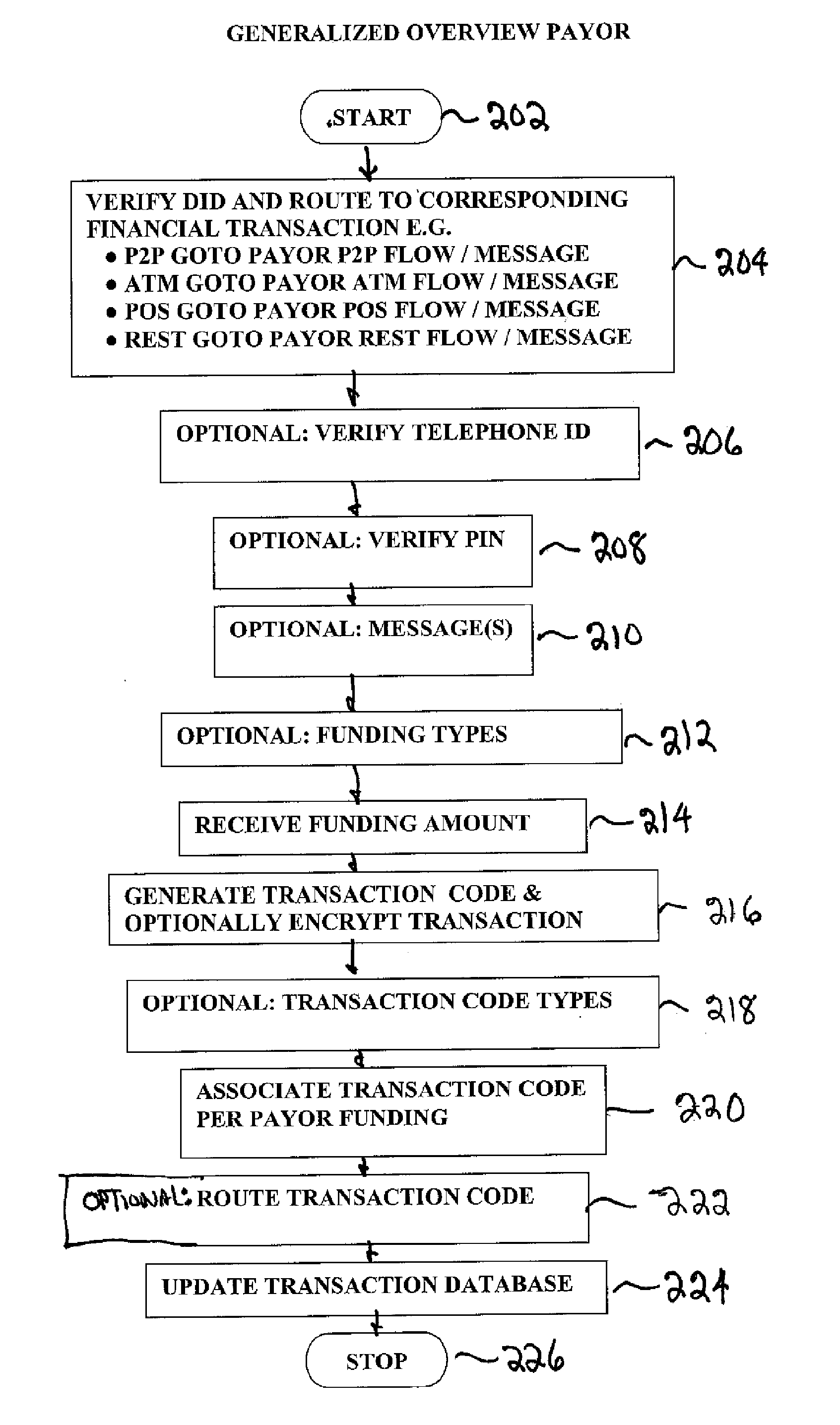

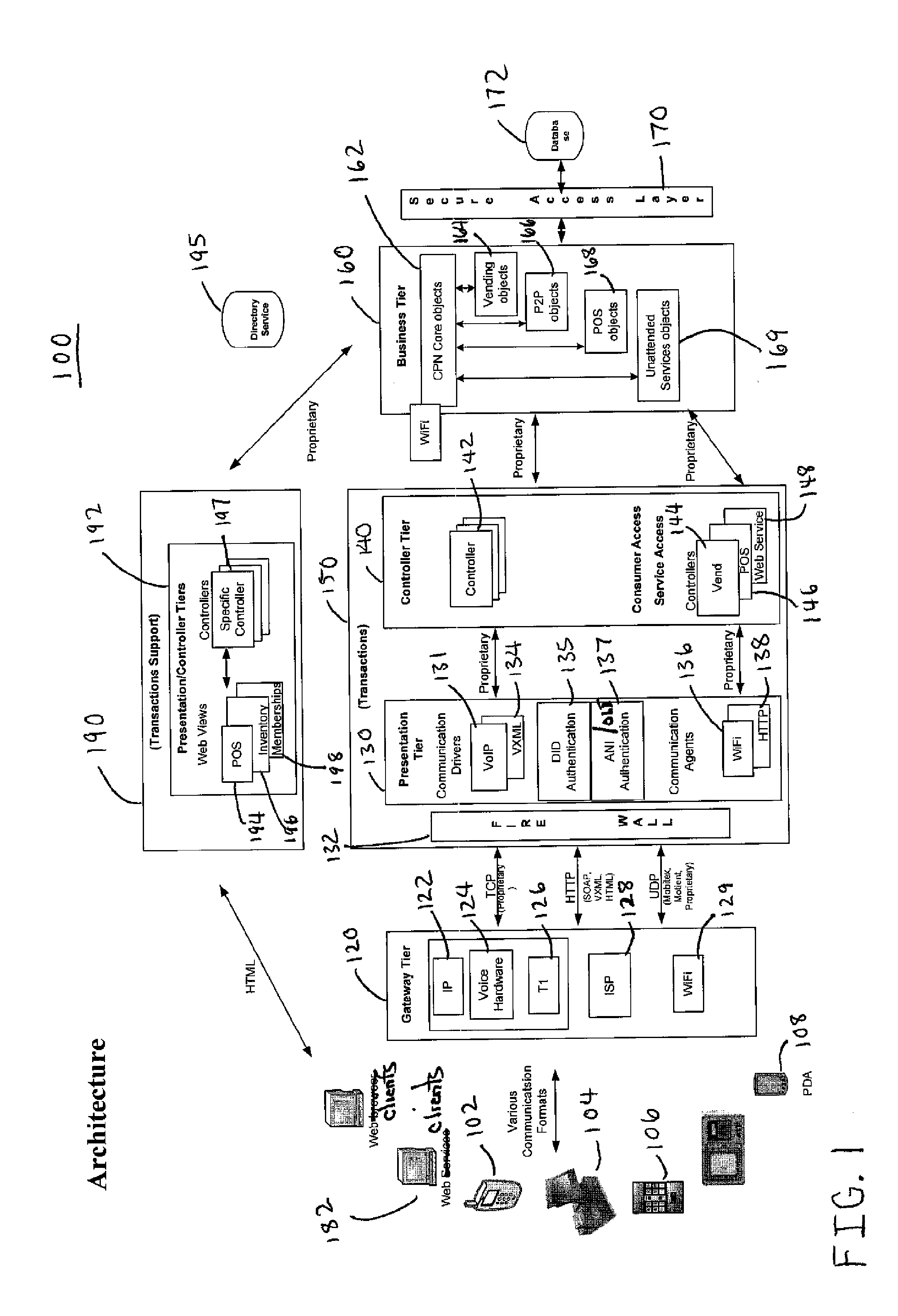

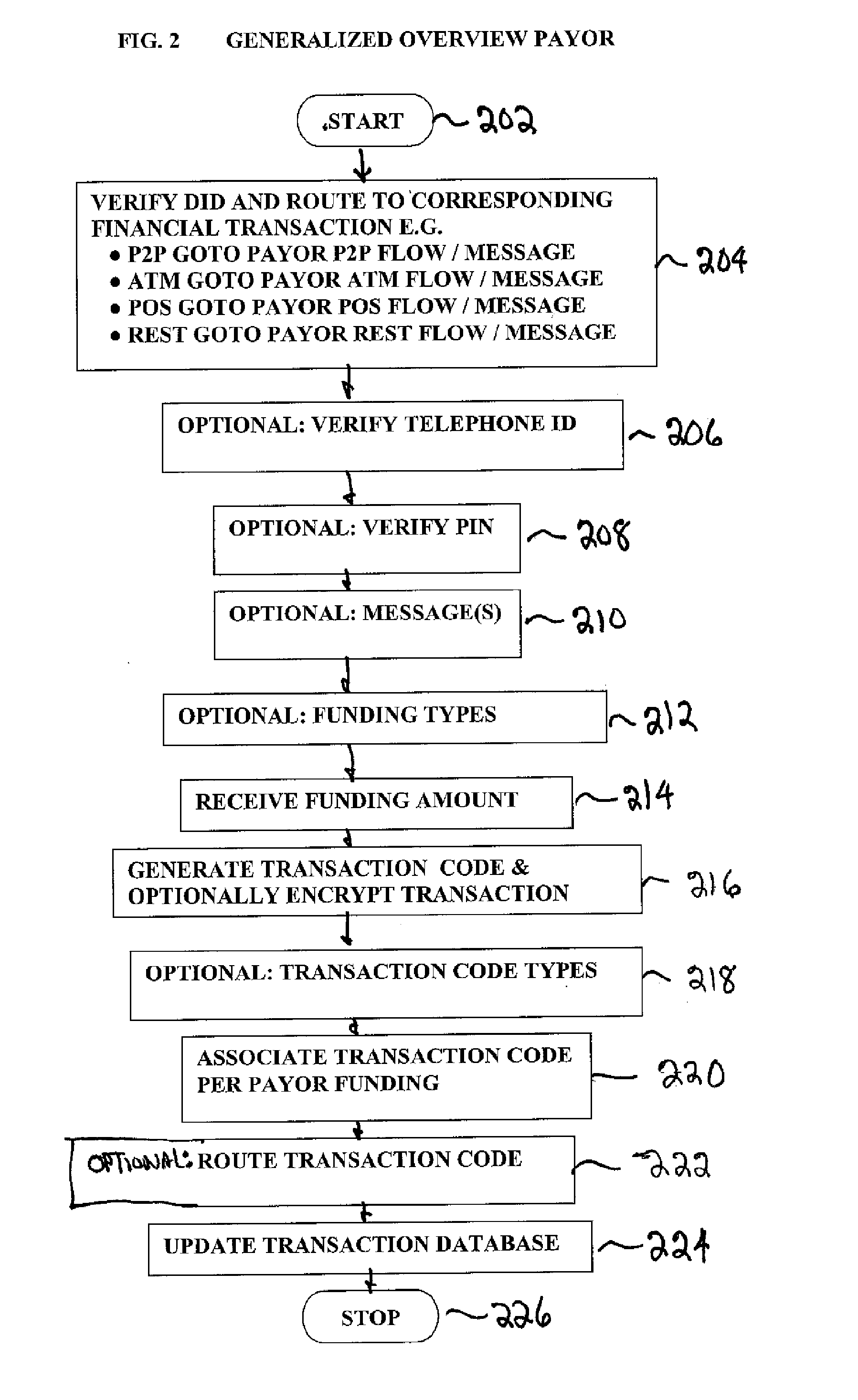

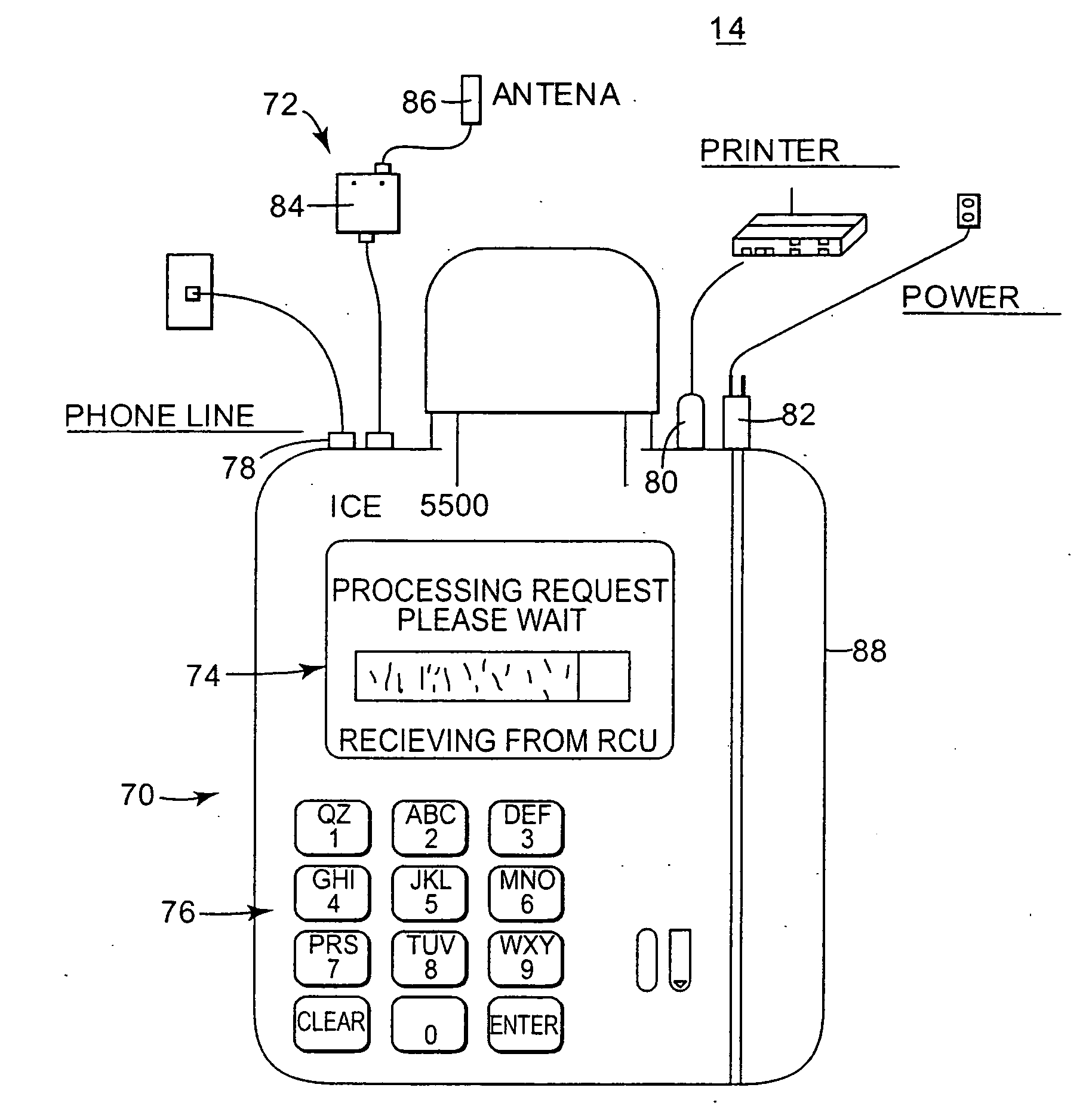

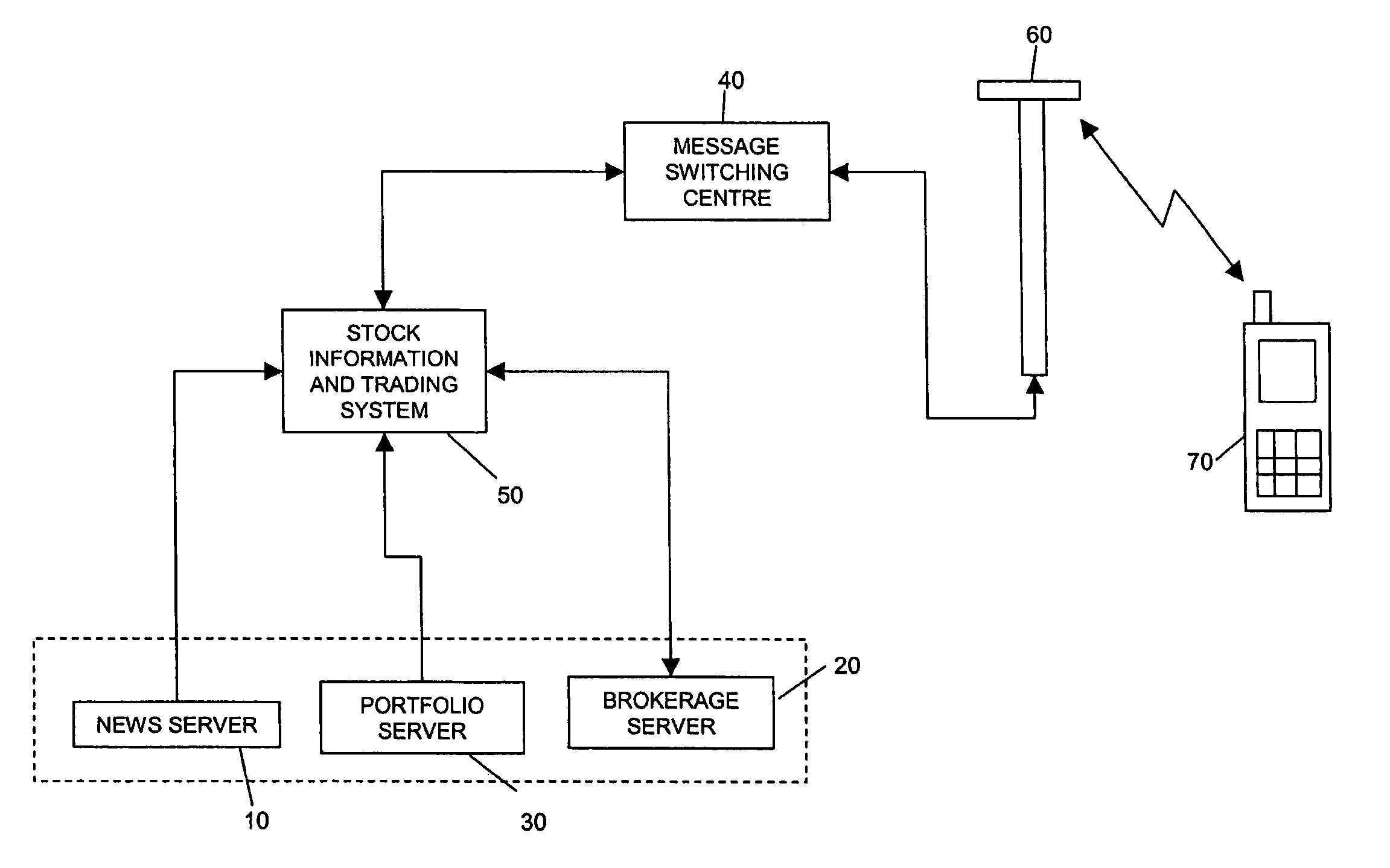

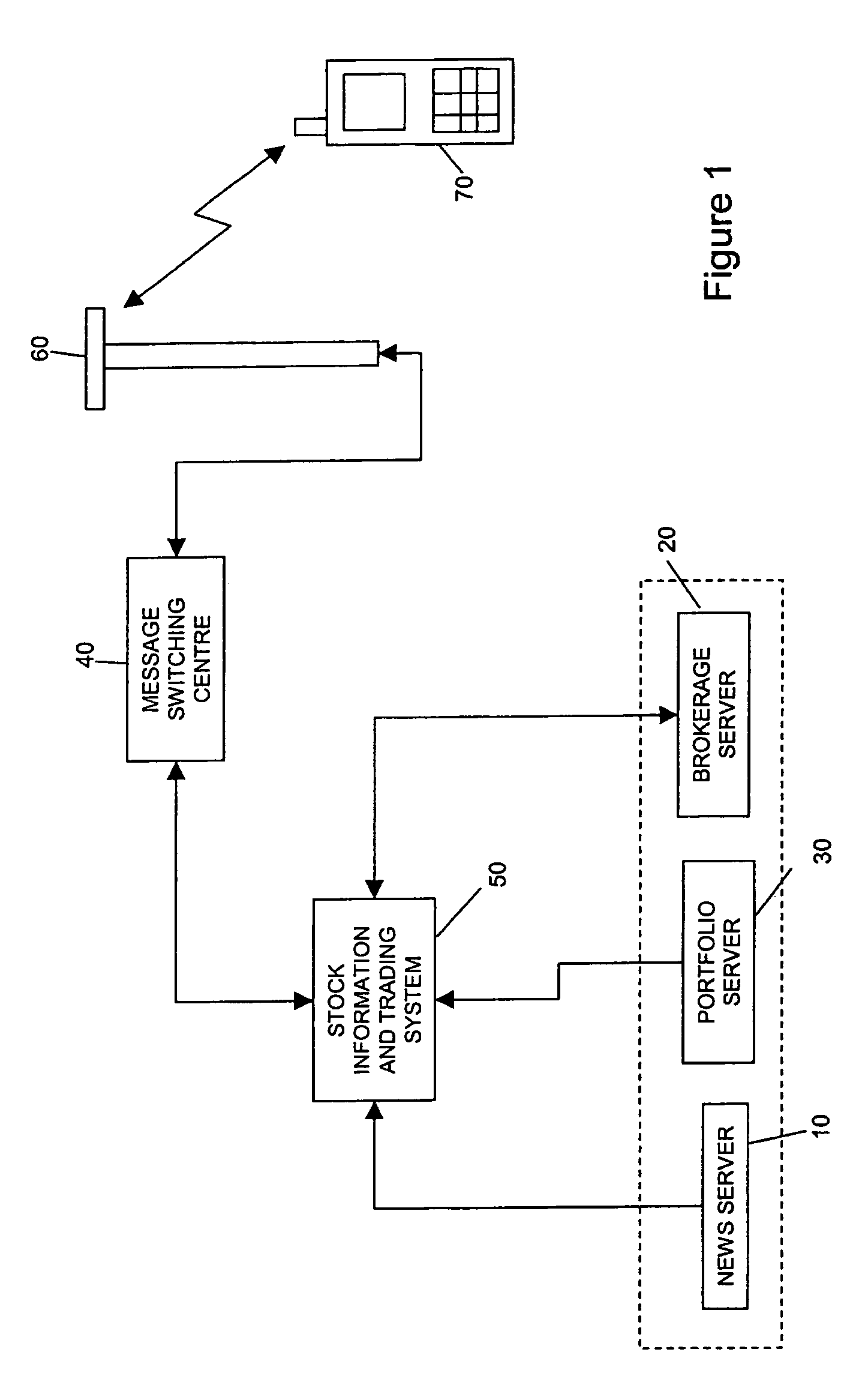

Financial transactions using a communication device

A computer implemented system provides a method of conducting a financial transaction. The method begins when the system assigns a designator of a value using a preauthorization by a payor. The system associates the payor with an authorized payor telephone identifier. When the system receives a telephone call with the authorized payor telephone identifier at a specified Direct Inward Dial (DID) telephone number associated with a transaction type, the system responds by sending at least one transaction code to the payor. When the system receives the transaction code from the payee, the designator of value is re-asssigned to from the payor to the payee. The system allows the transaction code to be delivered directly from the payor to the payee or sent automatically to the payee. Each DID telephone number represents different transaction types such as Automatic Teller Machine (ATM), Person-To-Person (P2P), merchant transactions, vending transactions and other types of transactions.

Owner:PHONE1

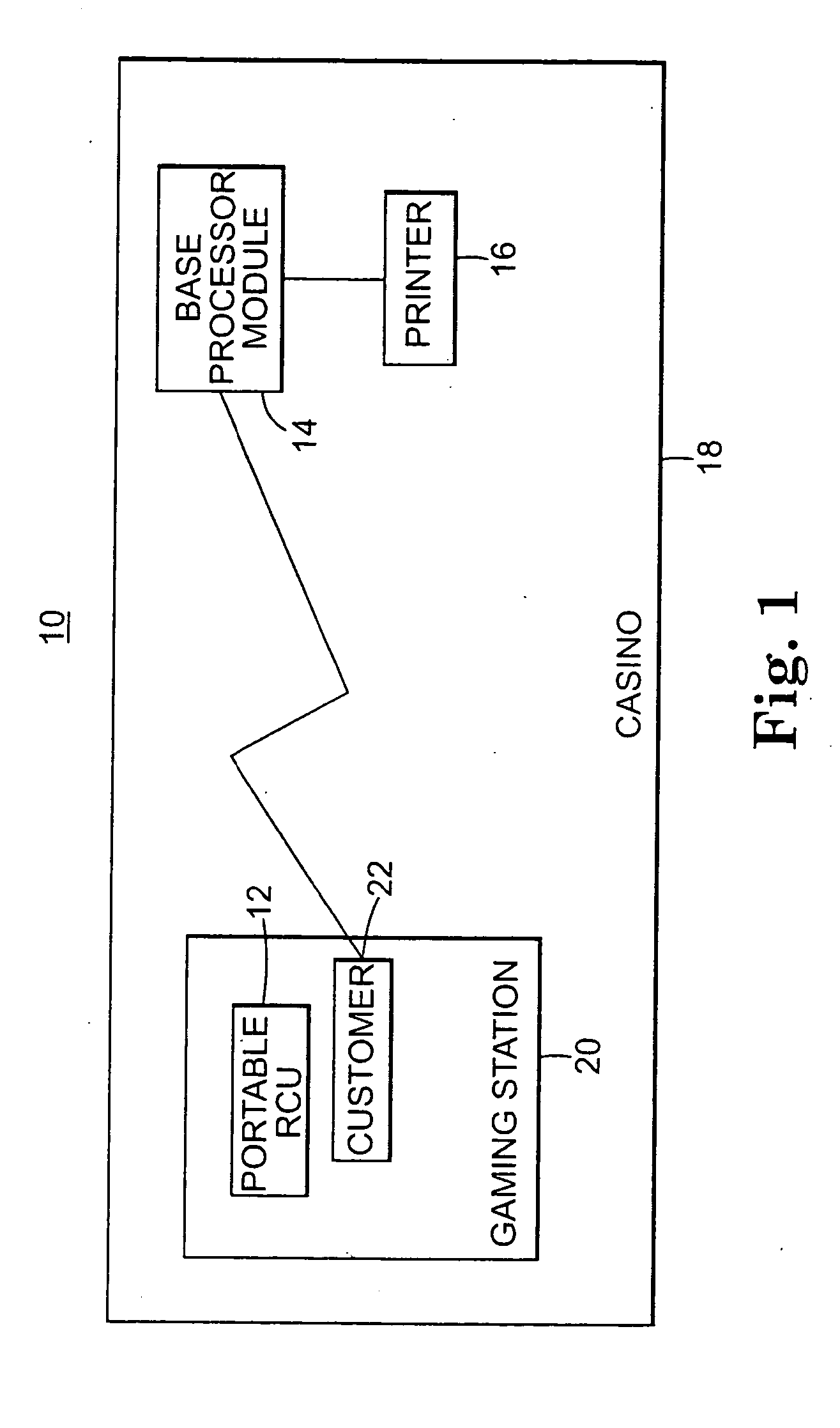

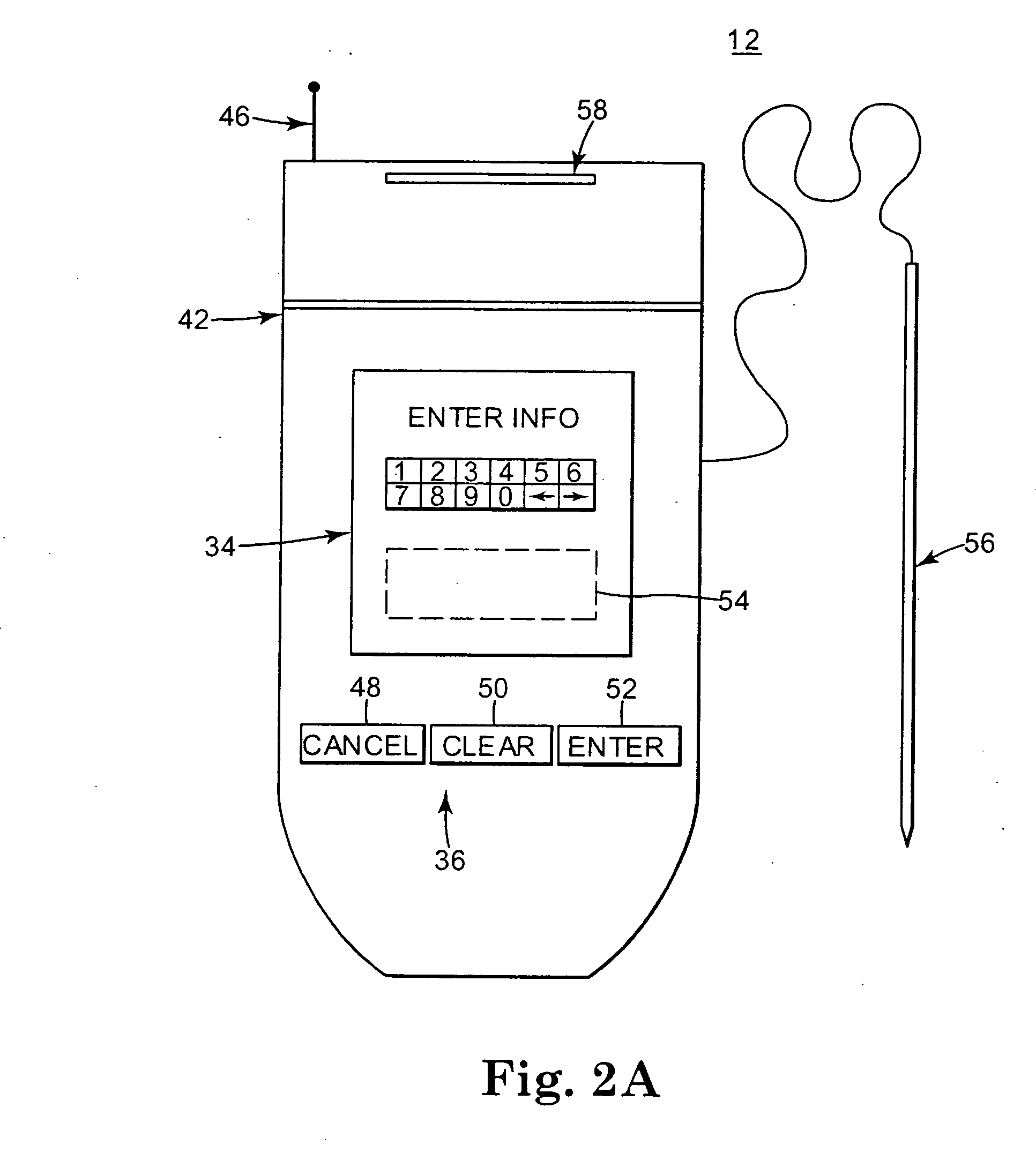

System and method for performing a financial transaction in an entertainment center

ActiveUS20060160610A1Easy to controlEfficient managementApparatus for meter-controlled dispensingAutomatic teller machinesRemote controlDistribution system

The present disclosure relates to a distribution system for providing cash or other items of value to a user at the location of the gaming system and a method for using the distribution system. The disclosure relates to a distribution system for use with an entertainment station. The distribution system includes a remote control unit accessible from the entertainment station and operably coupled to a base processor. The remote control unit is adapted to receive user account information and a requested transaction type from a group consisting of deposit, transfer, and withdrawal. The remote control unit is also adapted to provide a signal to the base processor, and the base processor is adapted to receive the signal from the remote control unit and to process the requested transaction type based on the account information. The base processor is adapted to distribute cash or cash equivalent to a user.

Owner:EVERI PAYMENTS

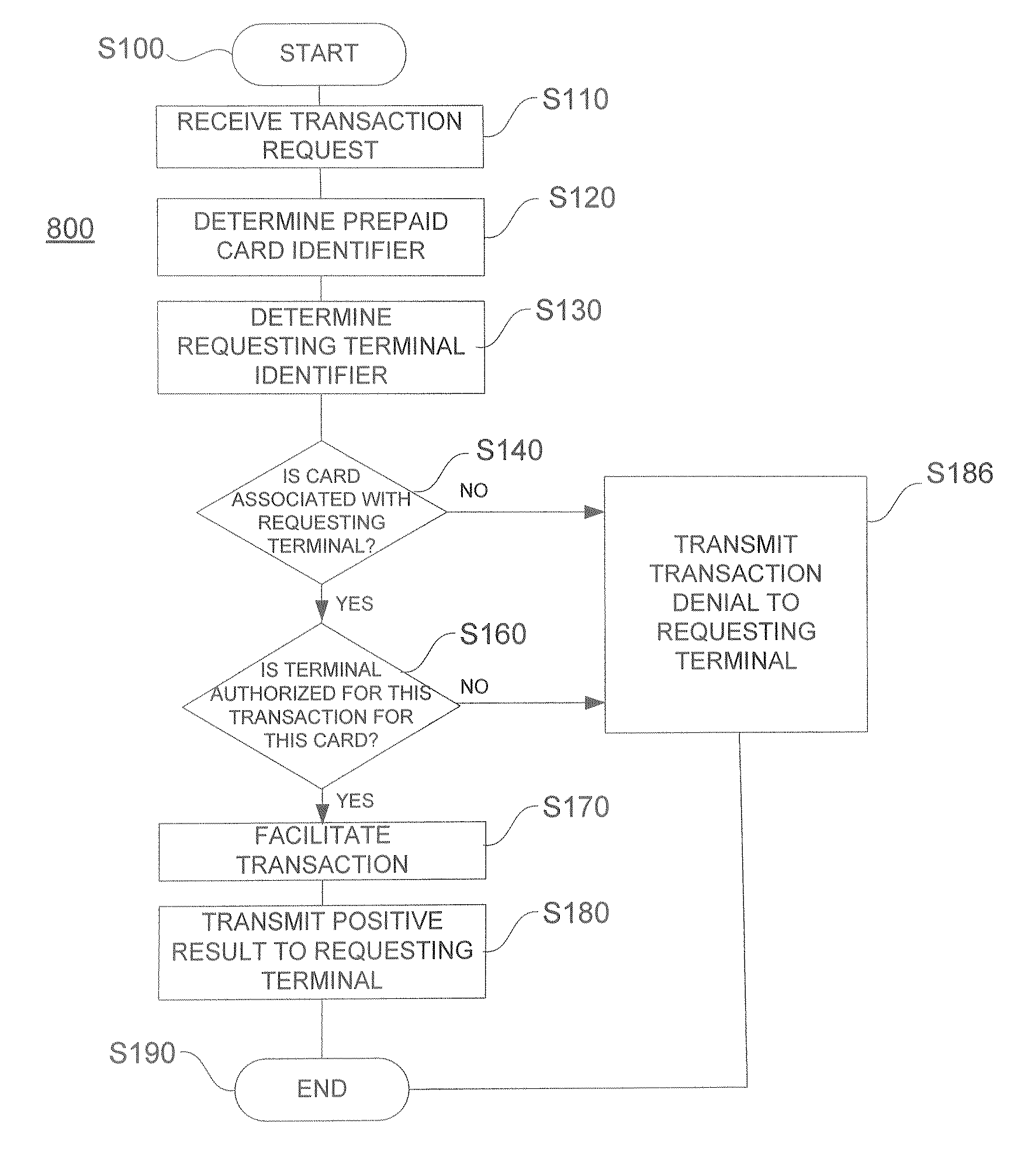

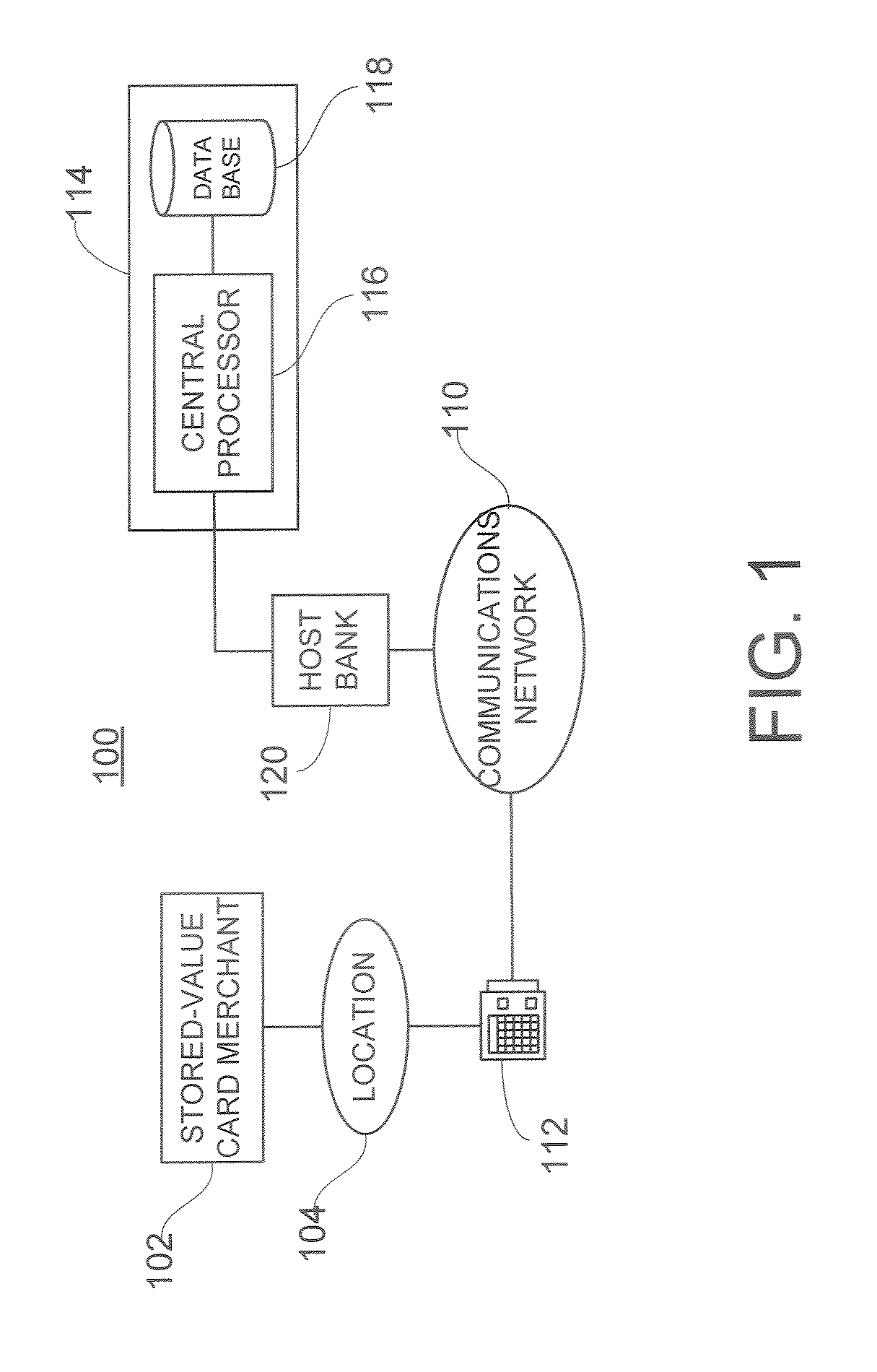

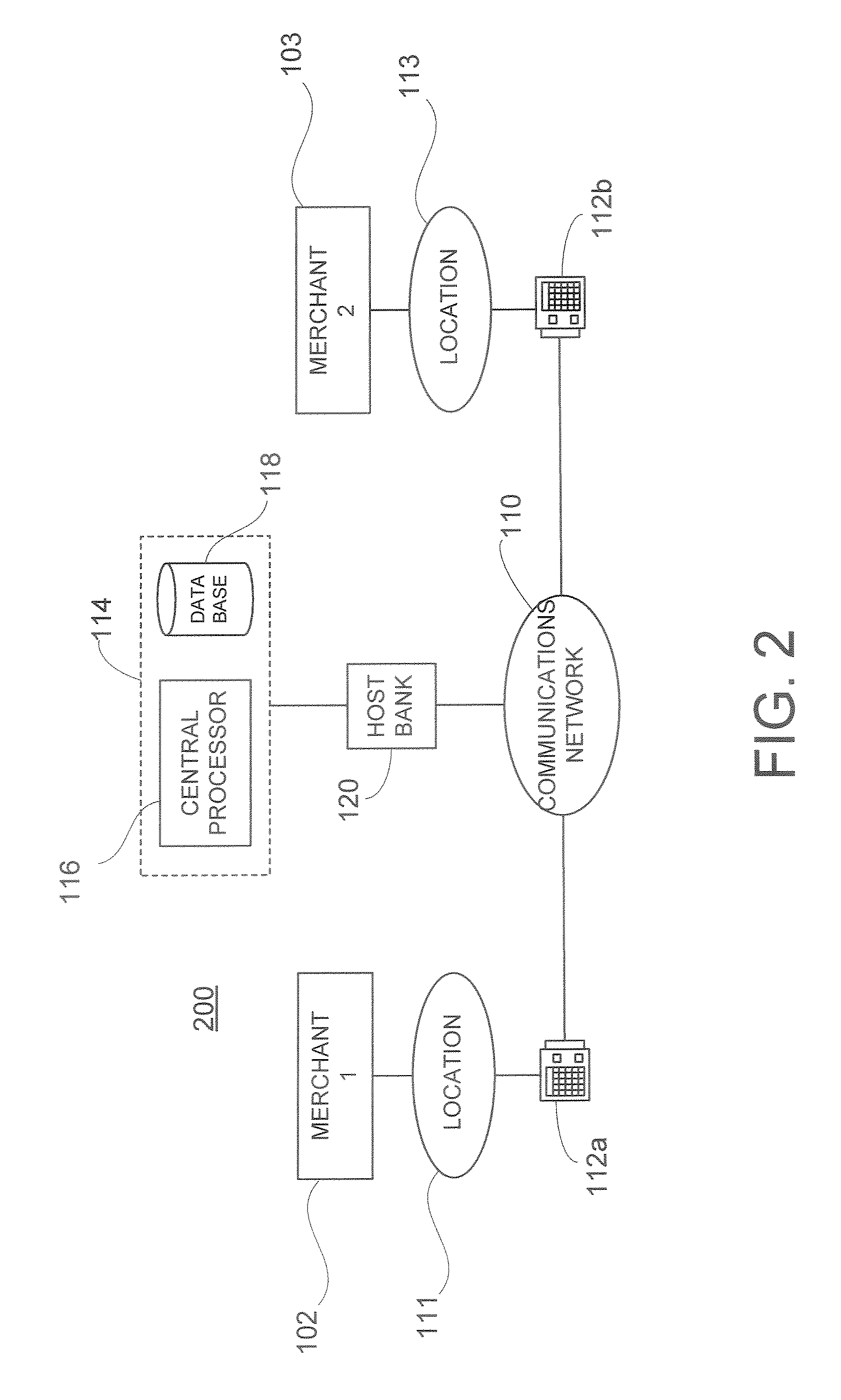

System and Method For Authorizing Stored Value Card Transactions

A computer-implemented method for processing a stored-value card transaction request in a card data management system is presented. The management system has a central processor in communication with one or more point-of-sale terminals over a communications network. Each terminal has a unique terminal identifier and is associated with a location and a prepaid card merchant. The central processor is in communication with a database having stored therein a plurality of card records. Each of these card records contains data associated with a stored-value card distributed to a prepaid card merchant for further distribution to purchasers at a location controlled by the prepaid card merchant. The transaction request comprises a requesting terminal identifier, a card identifier assigned to a stored value card, and information indicative of a requested transaction type. The method further comprises determining if the requesting terminal is authorized to request the requested transaction type for the stored value card.

Owner:E2INTERACTIVE INC D B A E2INTERACTIVE

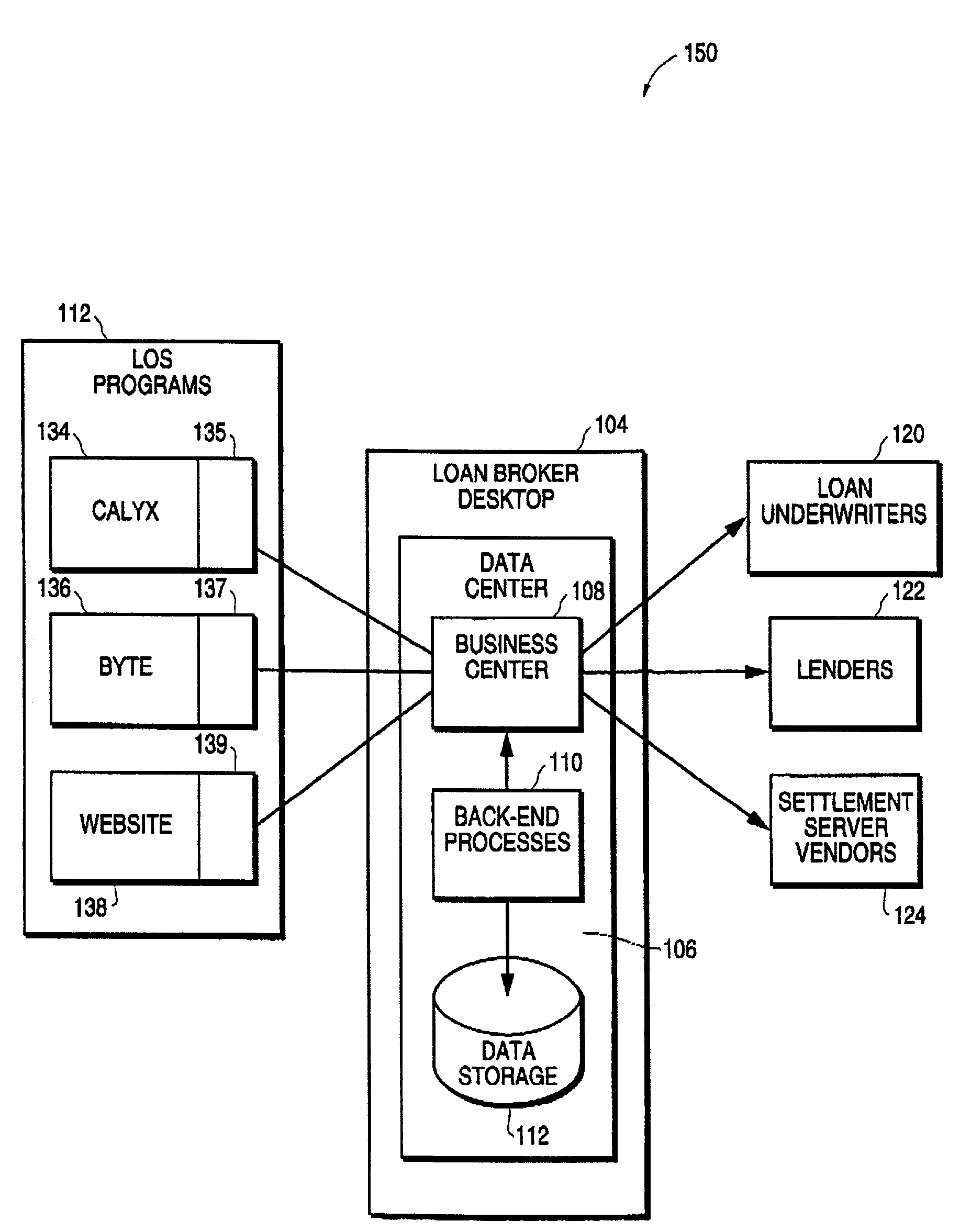

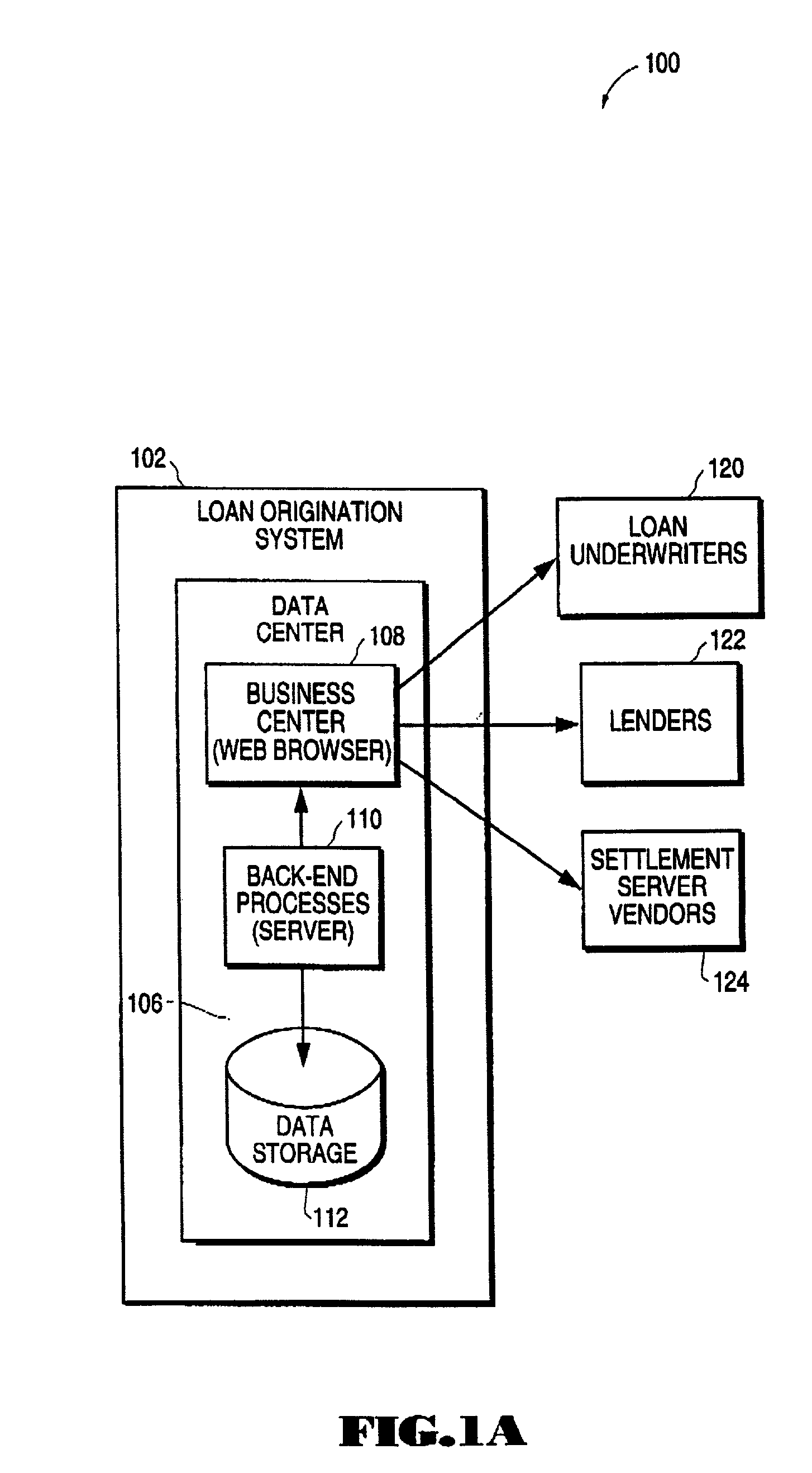

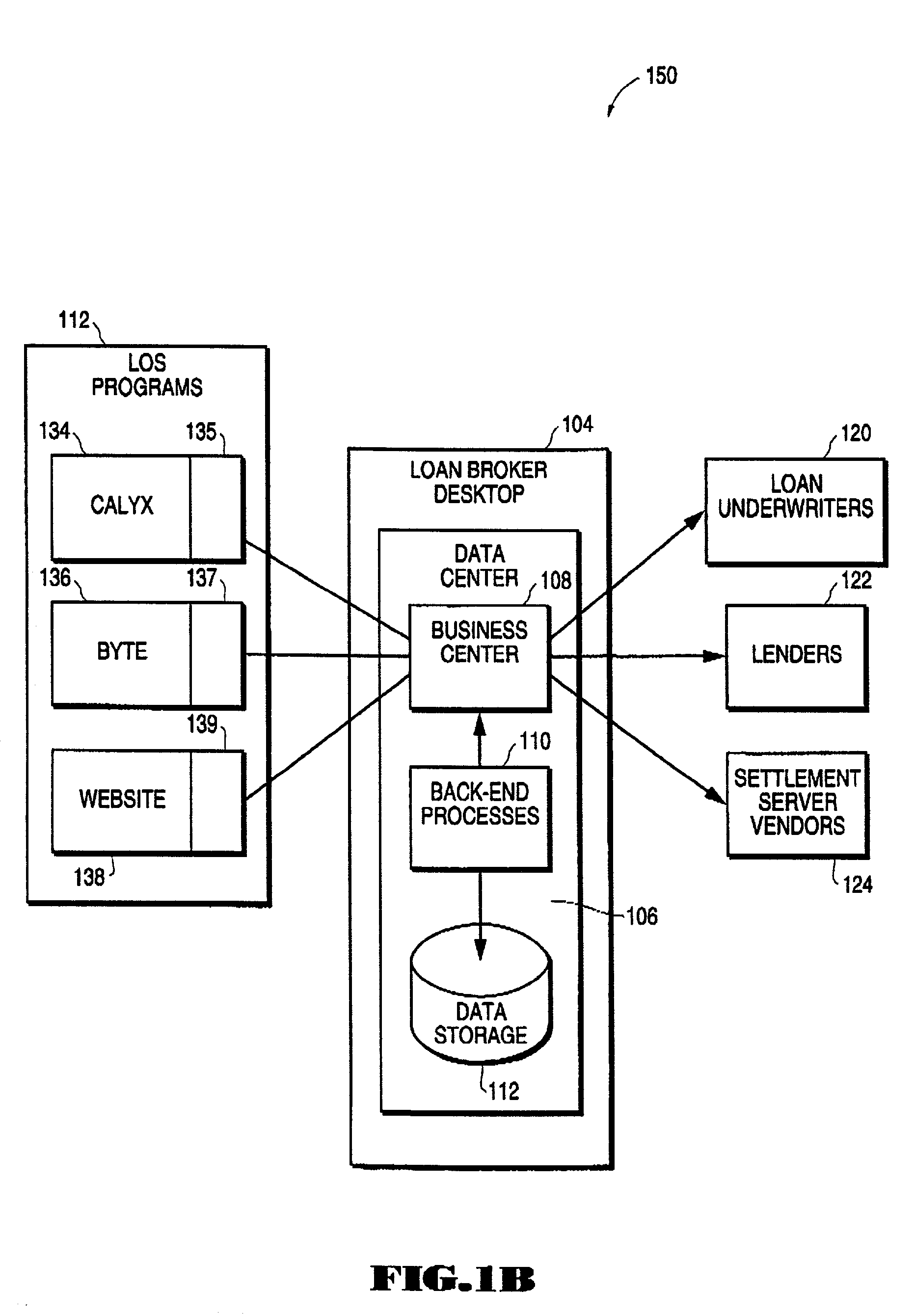

Online system for fulfilling loan applications from loan originators

A processing and submission client / server system transmits relevant loan information from a borrower to one or more lender computer systems through pre-defined file templates, which are utilized during loan origination. An automatic data flow process from the origination screen populates the relevant fields in any other related loan forms and word processing documents. Different forms are supported for different types of loans. The loan originator computer system includes a loan origination software program integrated with a web-browser based interface system. The interface system couples the loan origination software program to one or more partner computers. The partners comprise loan underwriters, lenders, and settlement service vendors. The interface system provides dynamic formatting and data transmission for different connections depending on the transaction type and target partner. In a web-based implementation, the interface system populates data directly from the loan origination software program to the appropriate web pages of the target partners.

Owner:ICE MORTGAGE TECH INC

Method and system to enable mobile transactions

ActiveUS7424303B2Easy mobile monitoringNo longer be usedFinanceCash registersInterface layerMobile transaction

Owner:CHEMTRON RES

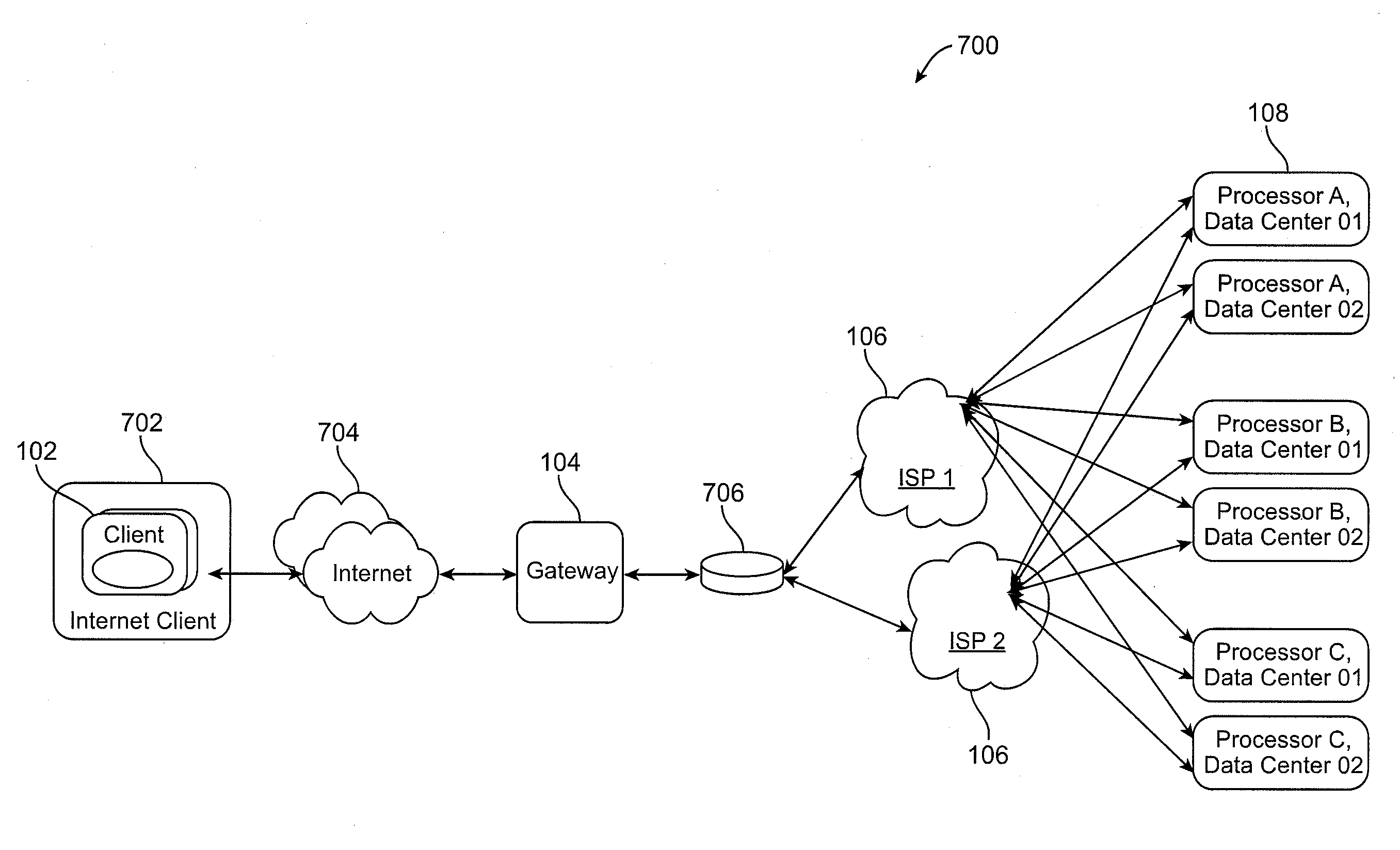

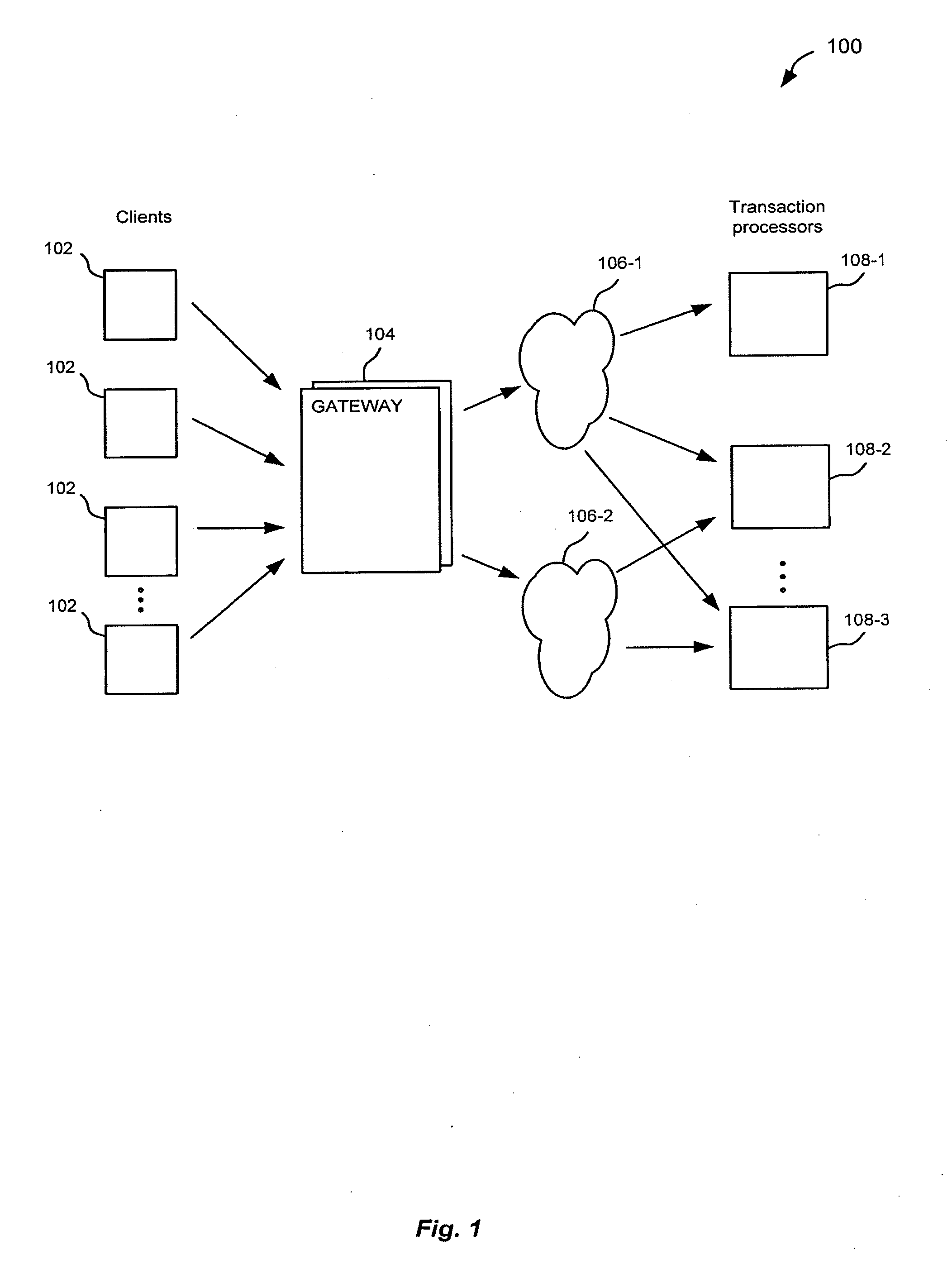

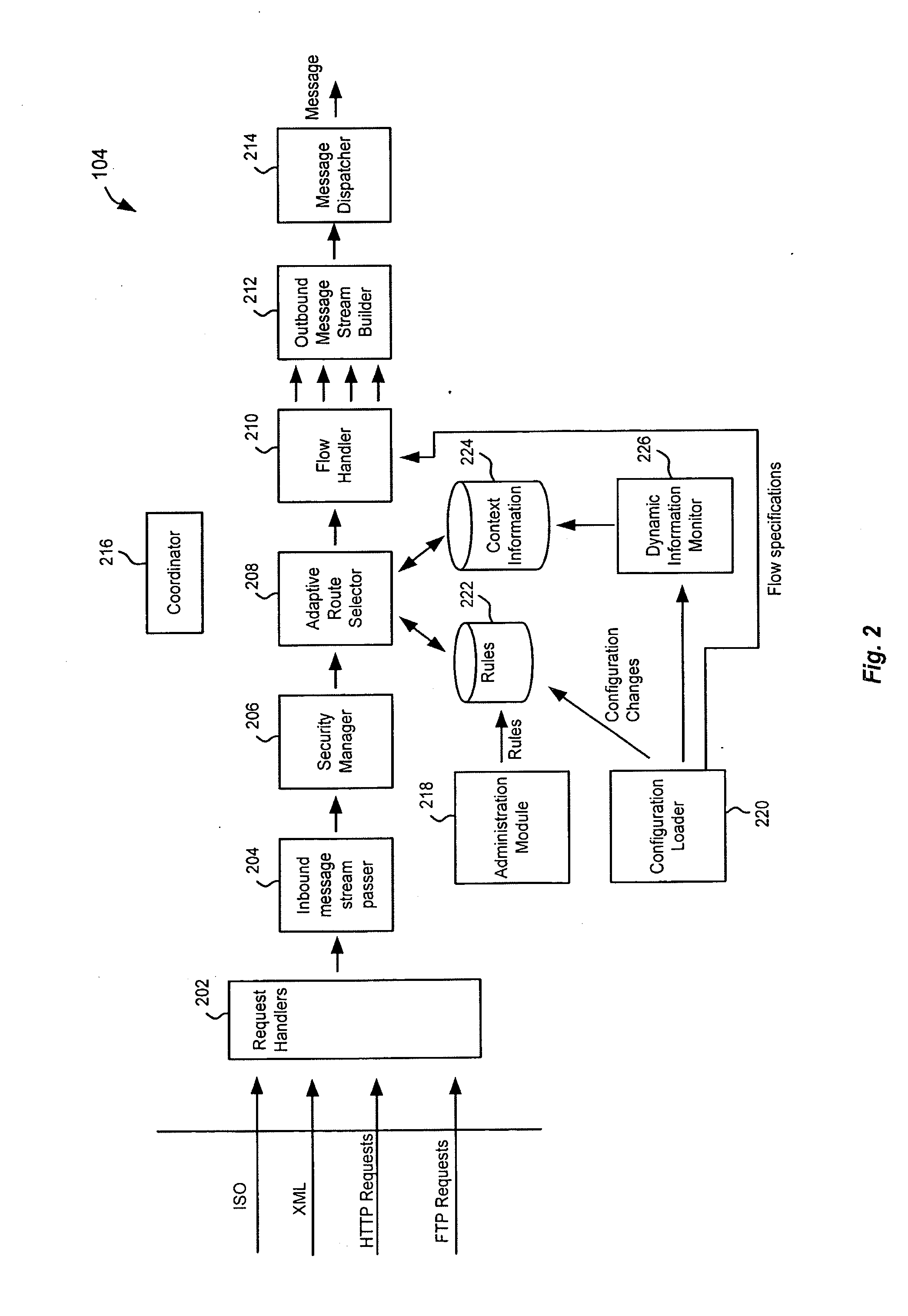

Adaptive gateway for switching transactions and data on unreliable networks using context-based rules

ActiveUS20110047294A1Data switching by path configurationMultiple digital computer combinationsModularityService selection

Application level switching of transactions at a gateway is provided. The gateway is configured to switch the transaction based on the application level content, a current state of a transport environment, and / or dynamic rules for switching transactions. For example, several possible service providers can be selected for the type of transaction, and the gateway can monitor not only the round-trip time through the network(s) to different possible service providers, but also the time required to complete the transaction at the application level and return a response. The application is chosen on the sending side of the network, and application level formatting is done on the sending side as well. The gateway uses modular code and data, and separate instances of processing code to allow dynamic updating. Rules for application service selection can be selectively uploaded to the gateway from a client. The rules for different available application services can be distributed across different gateways.

Owner:VISA USA INC (US)

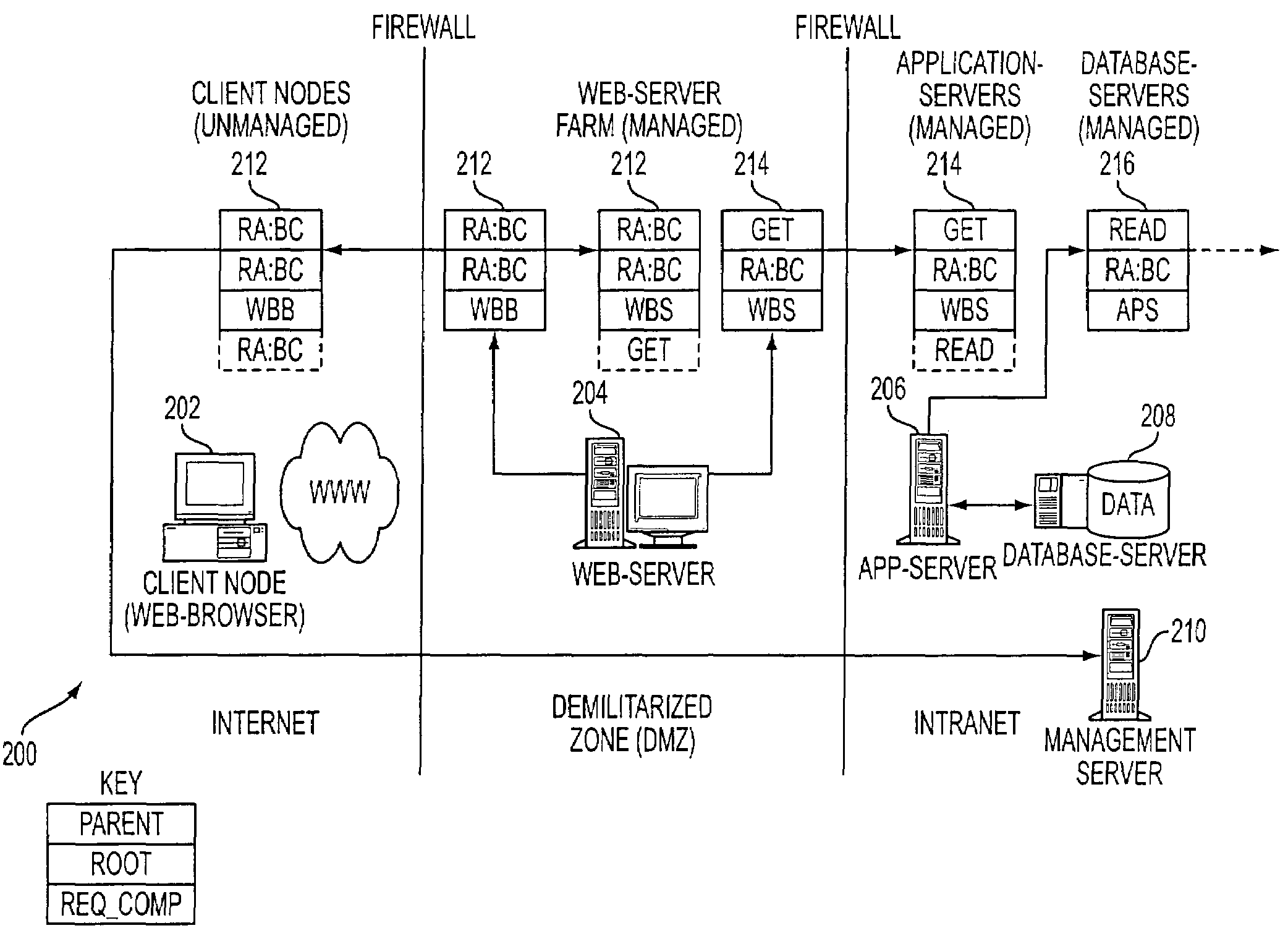

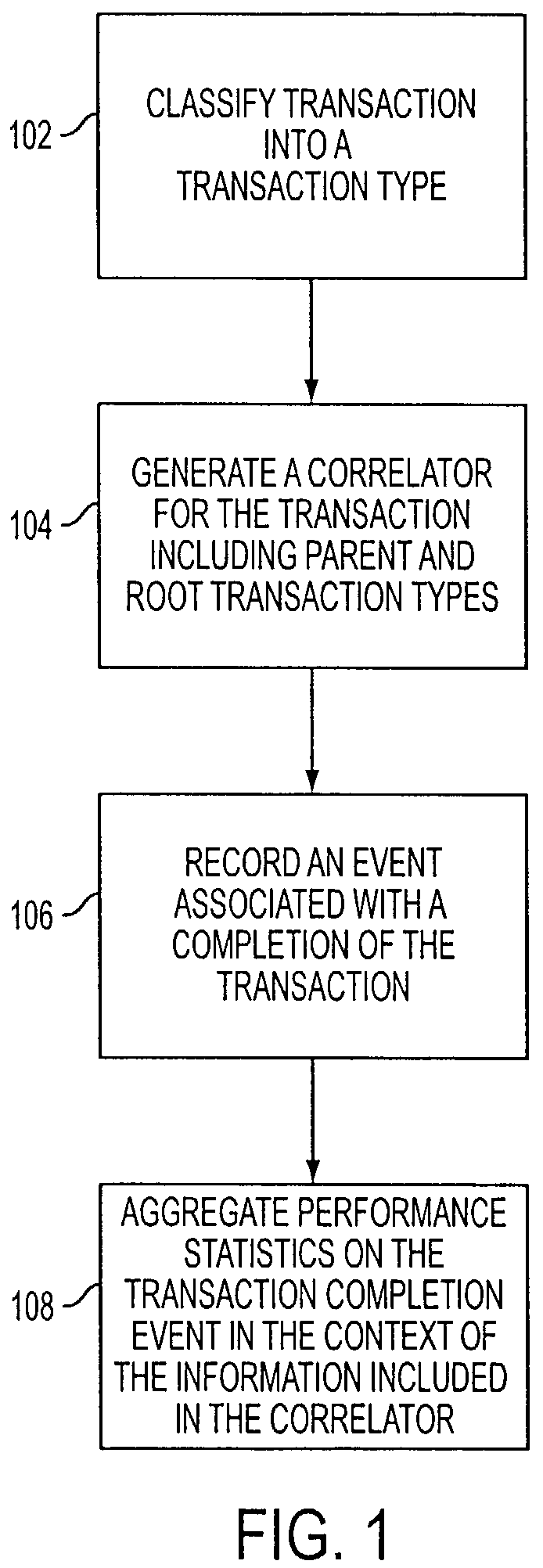

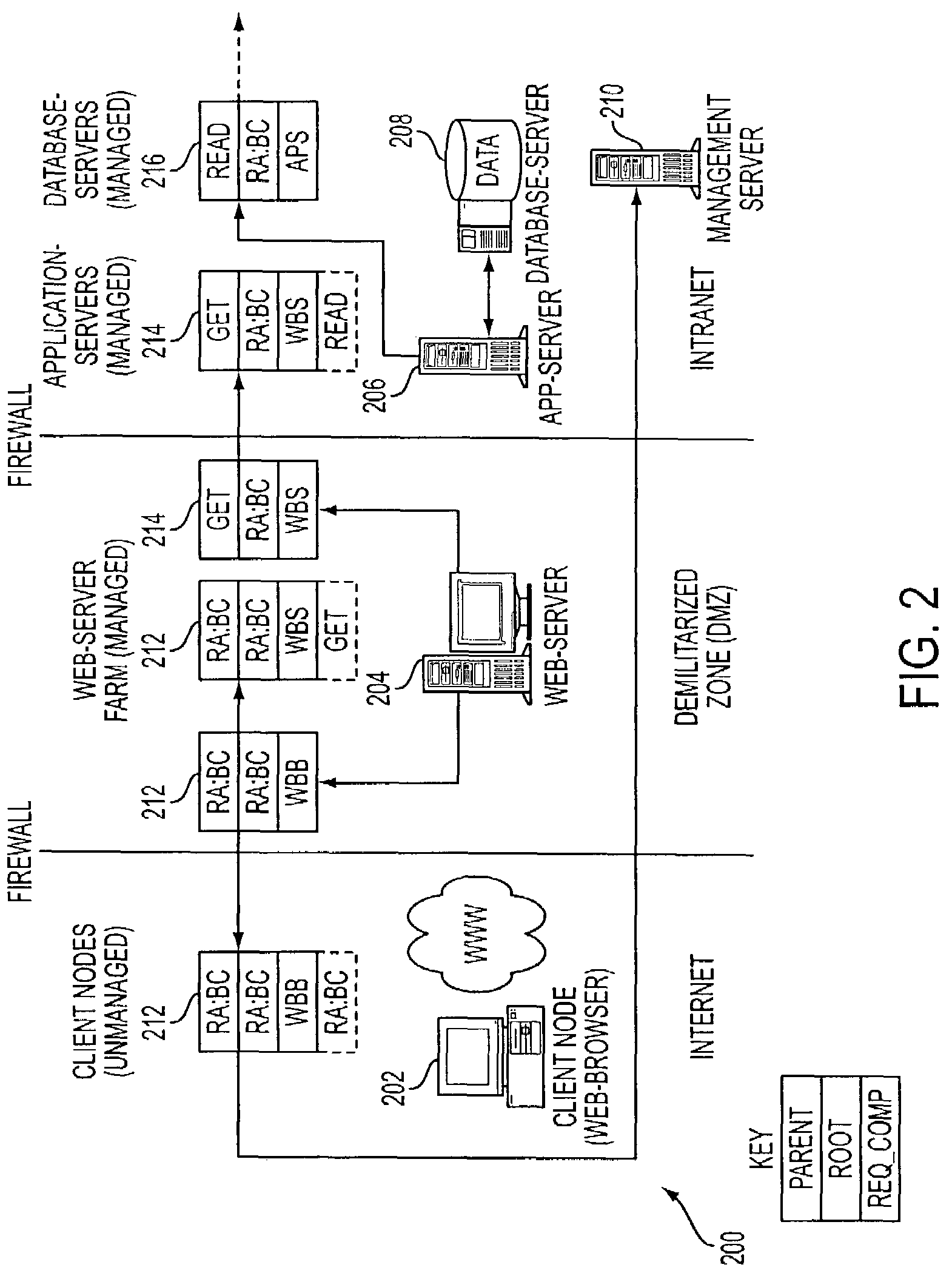

Method, system, and data structure for monitoring transaction performance in a managed computer network environment

A method, system, and data structure are disclosed for monitoring transaction performance in a managed computer network environment having a requesting component configured to request a transaction of a servicing component. In accordance with exemplary embodiments the transaction is classified into a transaction type. A correlator is generated for the transaction including information identifying a parent transaction type and a root transaction type of the transaction. An events associated with a completion of the transaction is recorded. Performance statistics are aggregated on the transaction completion event in the context of the information included in the correlator.

Owner:MICRO FOCUS LLC

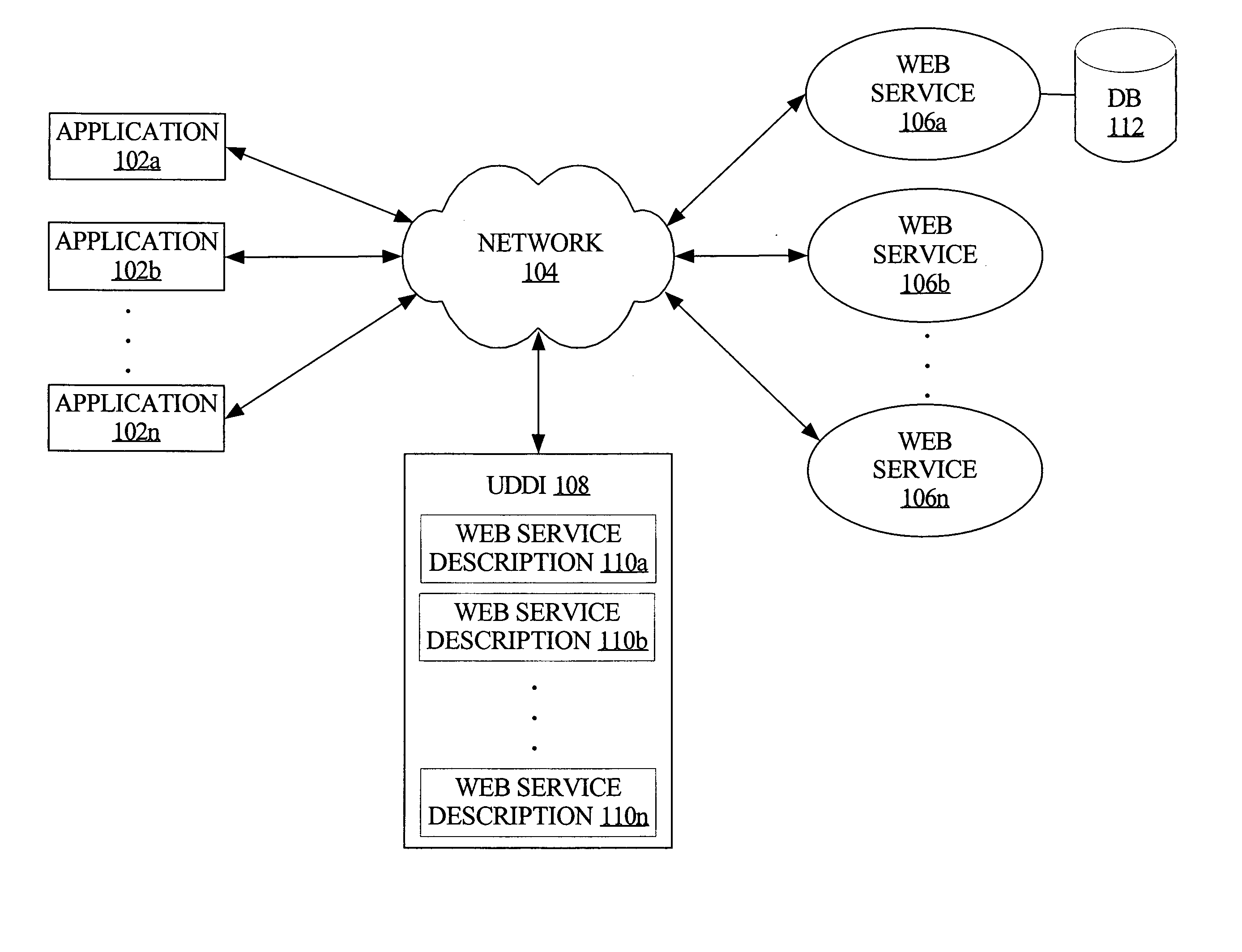

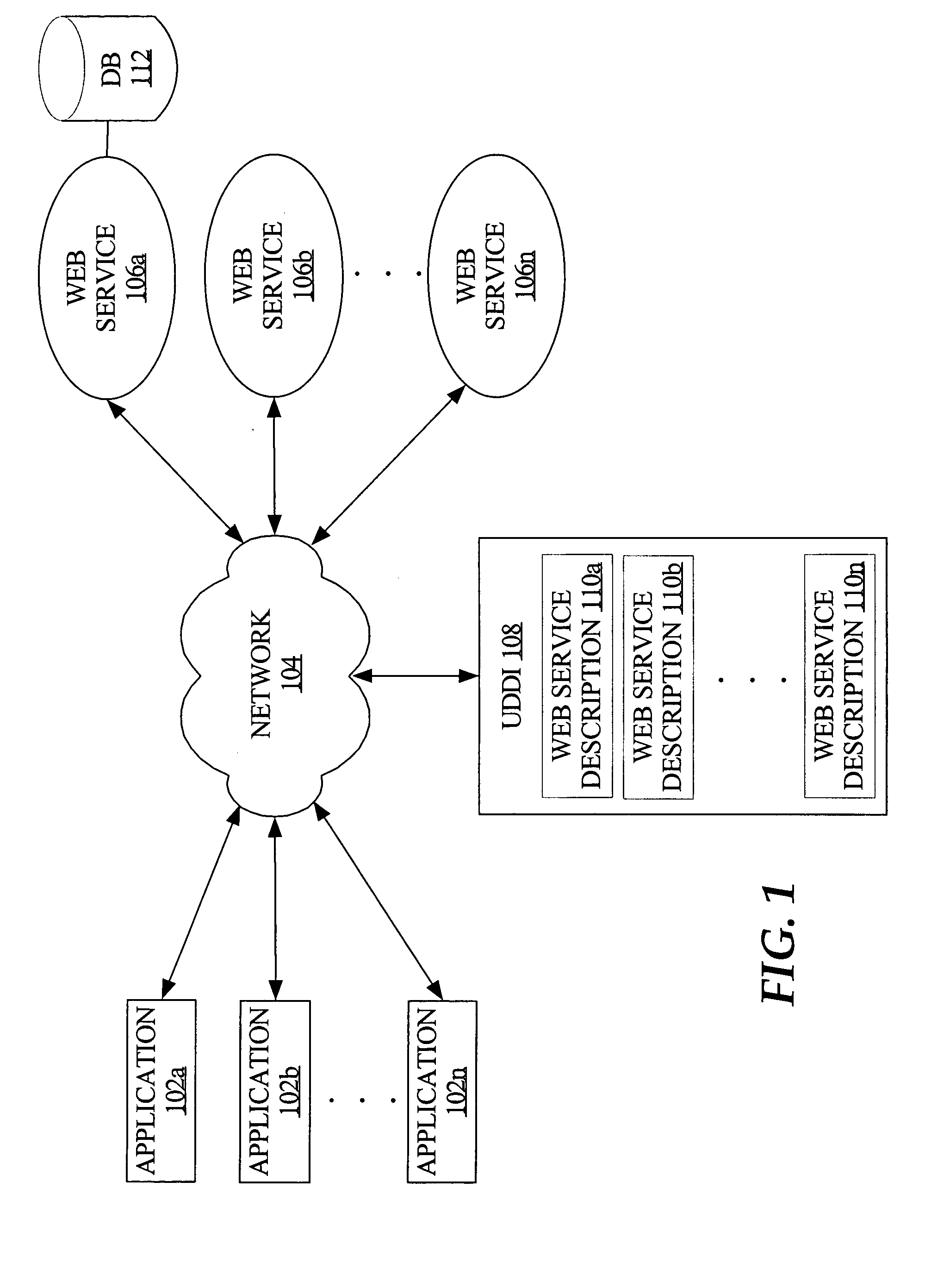

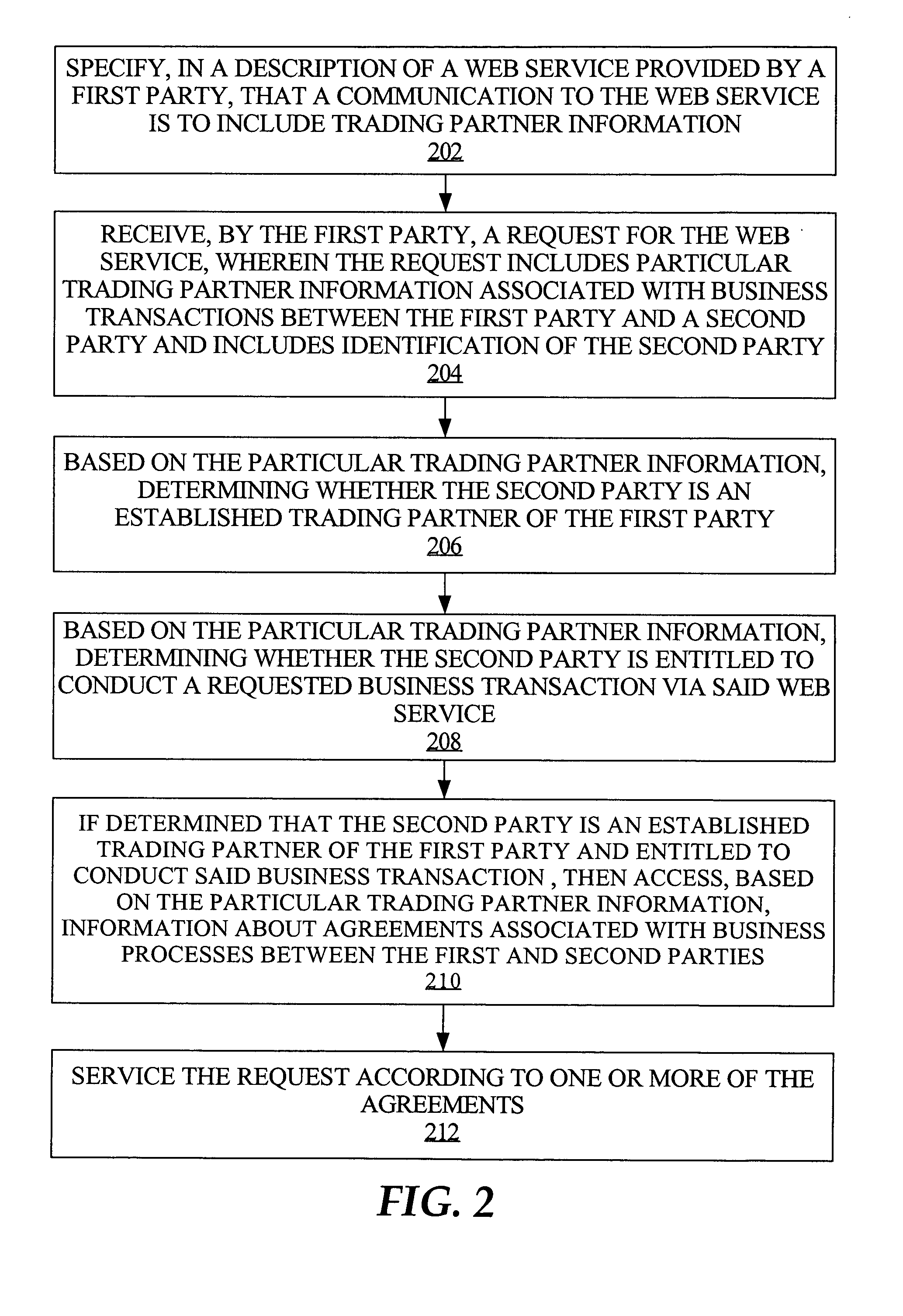

Enhanced security and processing for web service business transactions

ActiveUS20050086178A1Payment architectureBuying/selling/leasing transactionsWeb serviceService provision

A technique is described in which a web service provider is able to specify that messages related to business transactions with the web service includes trading partner information. For example, a provider may specify such requirements in a WSDL description of the relevant web service and may register the description with a UDDI registry. The trading partner information is regarding business transactions between the requesting party and the provider and is related to pre-established trading partner relationships and associated agreements and processes. Such trading partner information typically includes information that identifies, for example, the requesting party and the type of transaction. Consequently, the provider can determine whether the received request originates from an established trading partner and whether the requesting party is entitled to conduct the requested business transaction. Hence, application-level security is provided to electronic business transactions. Furthermore, enhanced processing of the business transaction results from being able to access, based on the received trading partner information, more elaborate data models associated with electronic transaction processes established between the trading partners.

Owner:ORACLE INT CORP

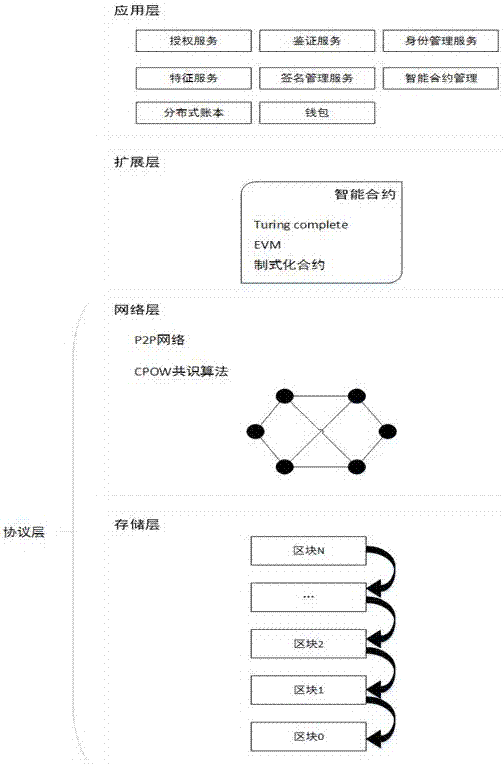

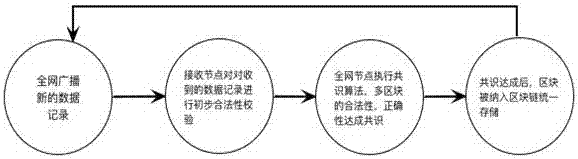

Intelligent contract gateway based on block chain CPOW consensus algorithm

InactiveCN107360238ACompatible with manySolve the problem of 51% attackPayment protocolsPayment circuitsThird partyData information

The invention relates to an intelligent contract gateway based on a block chain CPOW consensus algorithm. The gateway comprises a protocol layer, an expansion layer and an application layer, wherein the protocol layer comprises a network layer and a storage layer, the network layer comprises a p2p network and a CPOW consensus algorithm, and the storage layer stores data information onto a block chain; the expansion layer provides a basic transaction type defined by an agreement mode compatible with an Ethernet virtual machine based on a Bitcoin agreement and a programmable traction script of an original system; and the application layer comprises various services related to the intelligent contract gateway, and helps a user rapidly to get start the block chain services. The intelligent contract gateway provided by the invention provides strong support based on the block chain to third-party developers, is compatible with more applications, and thus the block chain can be more fast applied to a client; the CPOW consensus algorithm provided by the invention solves 51% attack problems, and greatly enhances transaction performance, and thus the application building cost and speed of the intelligent contract gateway based on the block chain CPOW consensus algorithm are greatly improved.

Owner:光载无限(北京)科技有限公司

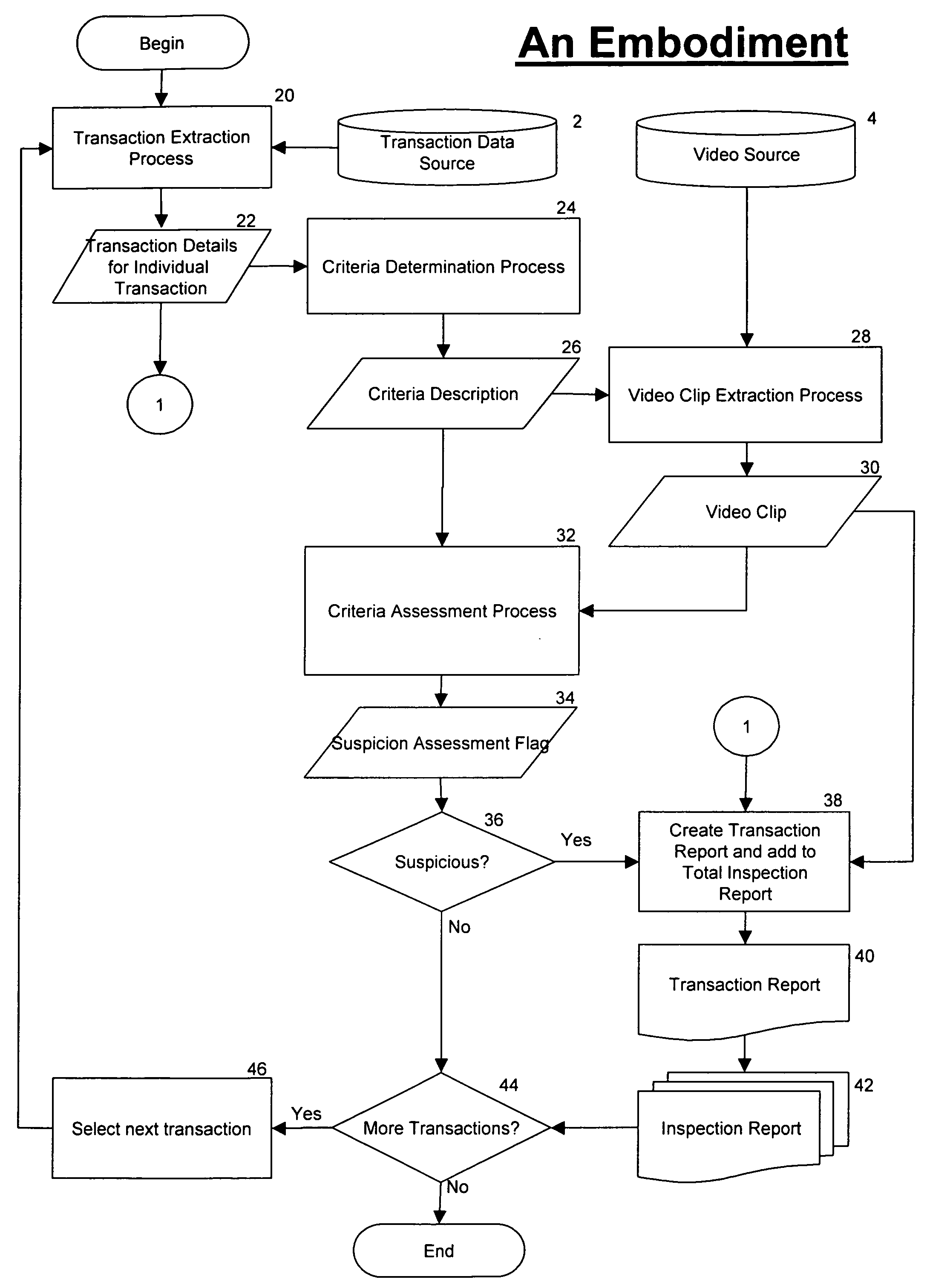

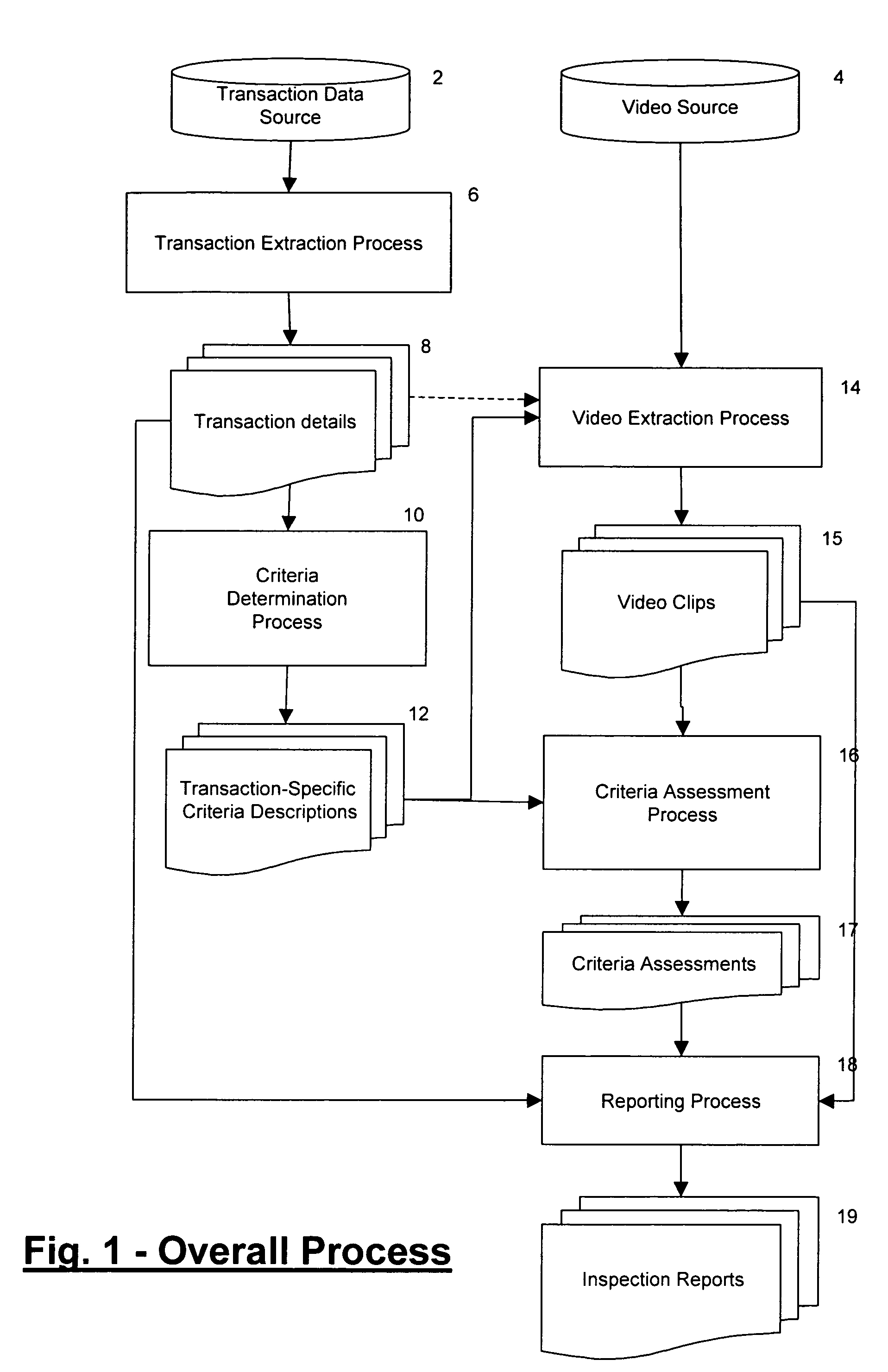

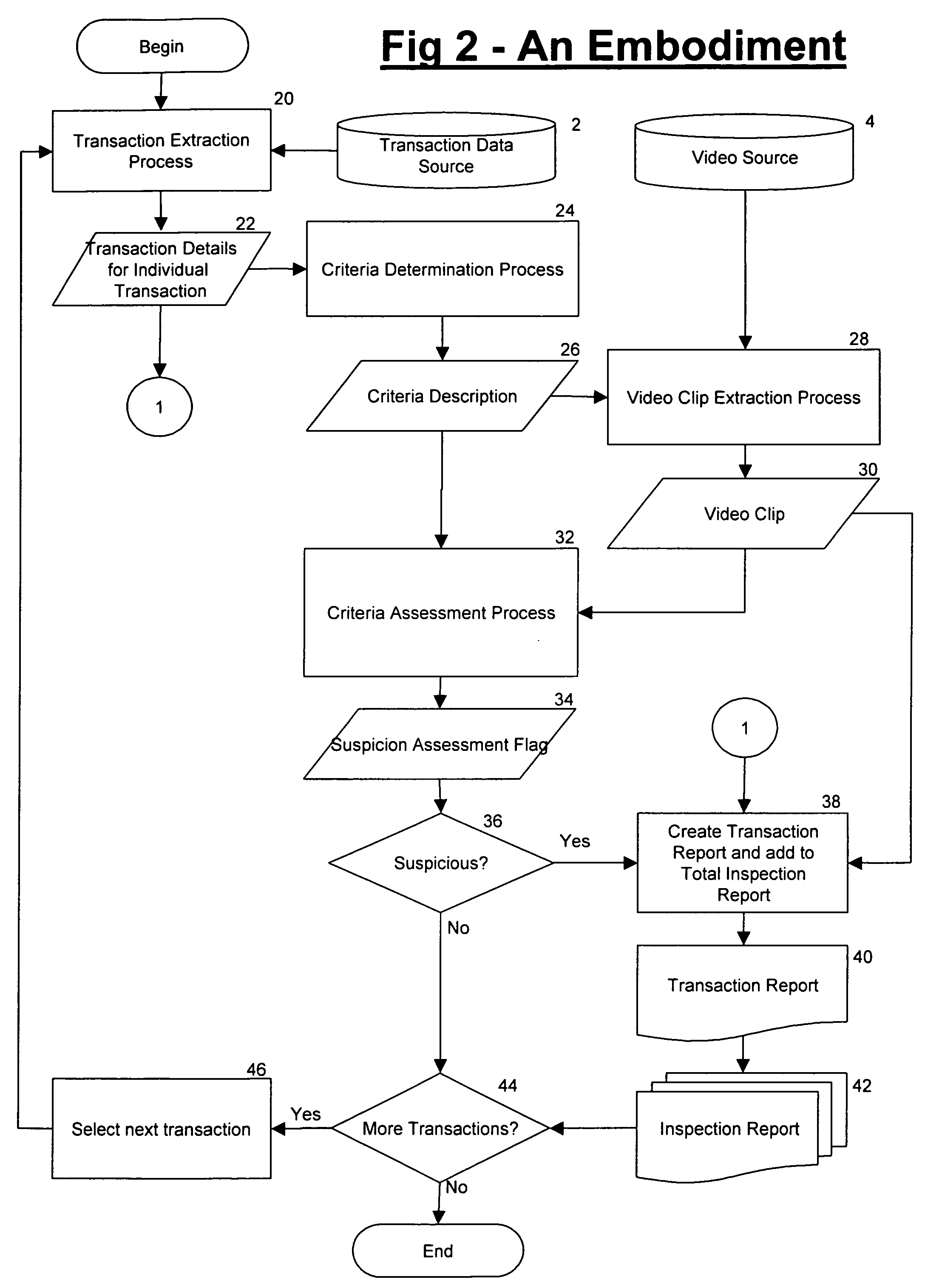

Method and apparatus for auditing transaction activity in retail and other environments using visual recognition

ActiveUS7516888B1Quick identificationShorten the timePayment architectureApparatus for meter-controlled dispensingTransaction dataFinancial transaction

A system detects a transaction outcome by obtaining video data associated with a transaction area and by obtaining transaction data concerning at least one transaction that occurs at the transaction area. The system correlates the video data associated with the transaction area to the transaction data to identify specific video data captured during occurrence of that at least one transaction at the transaction area. Based a transaction classification indicated by the transaction data, the system processes the video data to identify appropriate visual indicators within the video data that correspond to the transaction classification.

Owner:NCR CORP

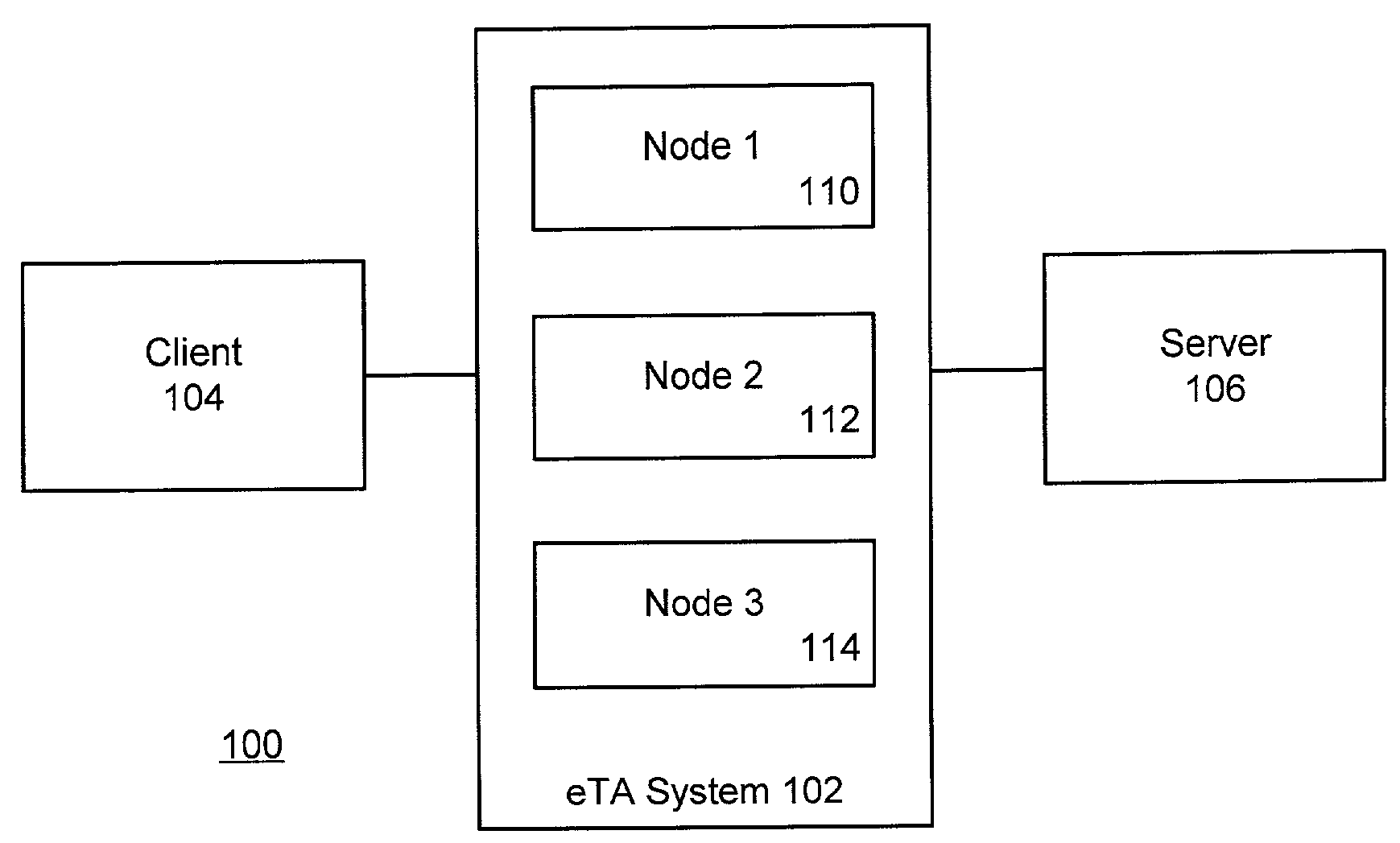

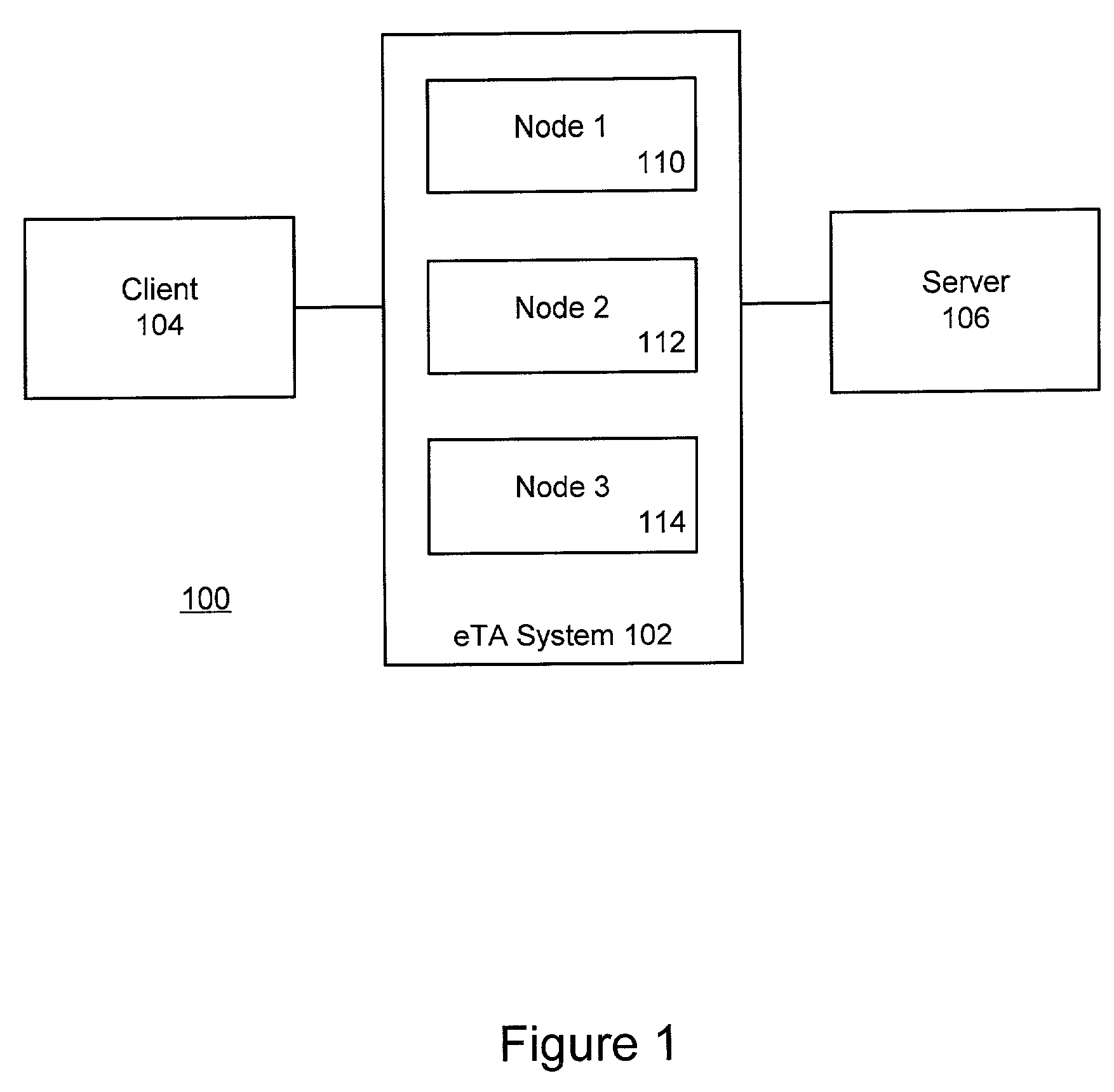

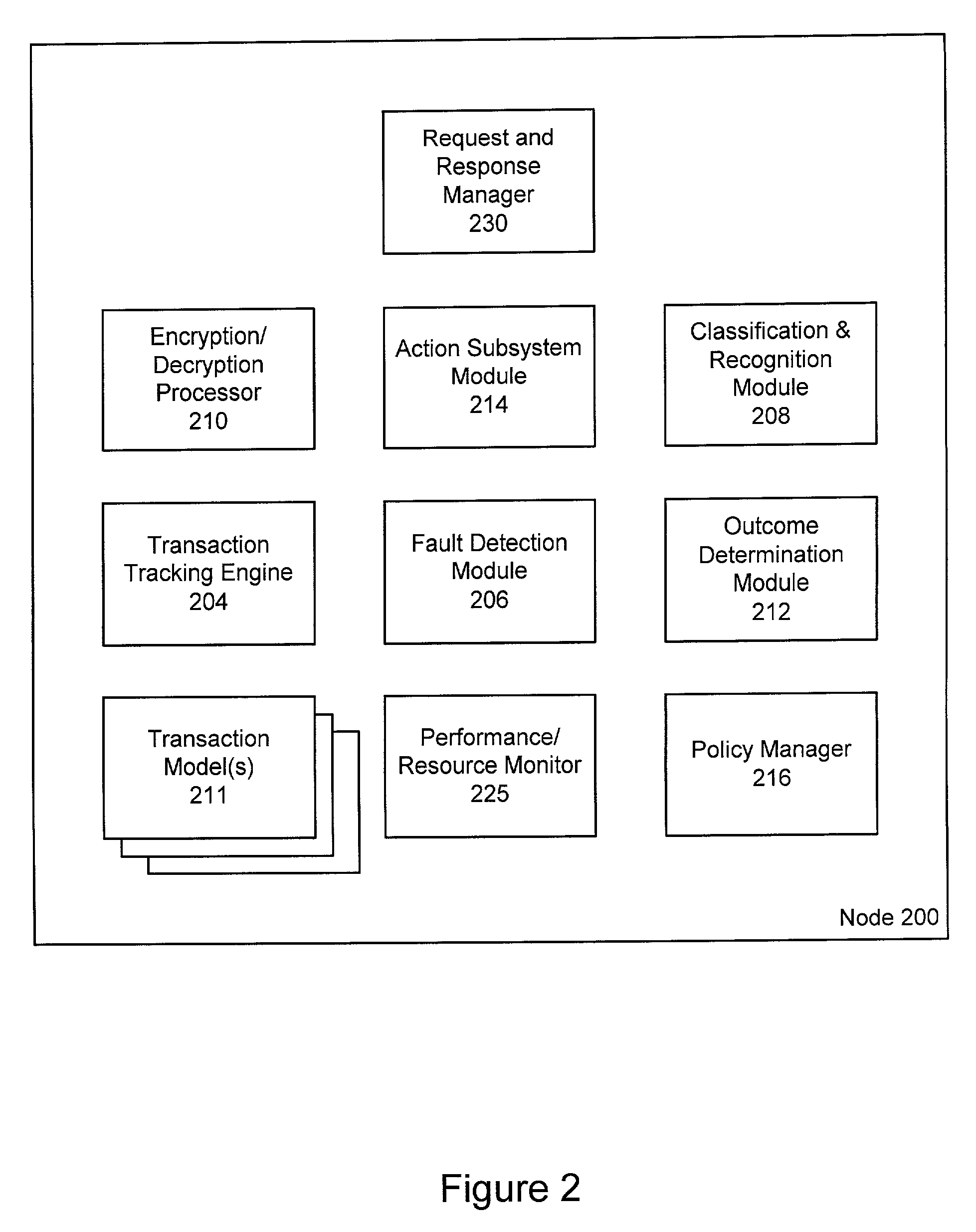

Highly available transaction failure detection and recovery for electronic commerce transactions

ActiveUS7539746B2Effective trackingMultiple digital computer combinationsTransmissionNetwork connectionTransaction model

Electronic commerce transaction messages are processed over a network between a client and a server in a highly reliable fashion by establishing a secure or un-secure communications connection between the network client and the network server at an electronic transaction assurance (eTA) system, which is located in a communication path between the network client and the network server. The transaction type is identified in the message and the progress of the transaction is tracked using transaction models. Any failure in the back-end server system or in the network connections is detected and the failure is recovered from using an outcome determination technique. The failure of a node within the eTA system is masked from the network client by formulating an appropriate response and sending it back to the client such that the network client and network server that were using the selected node do not see any interruption in their communications.

Owner:EMC IP HLDG CO LLC

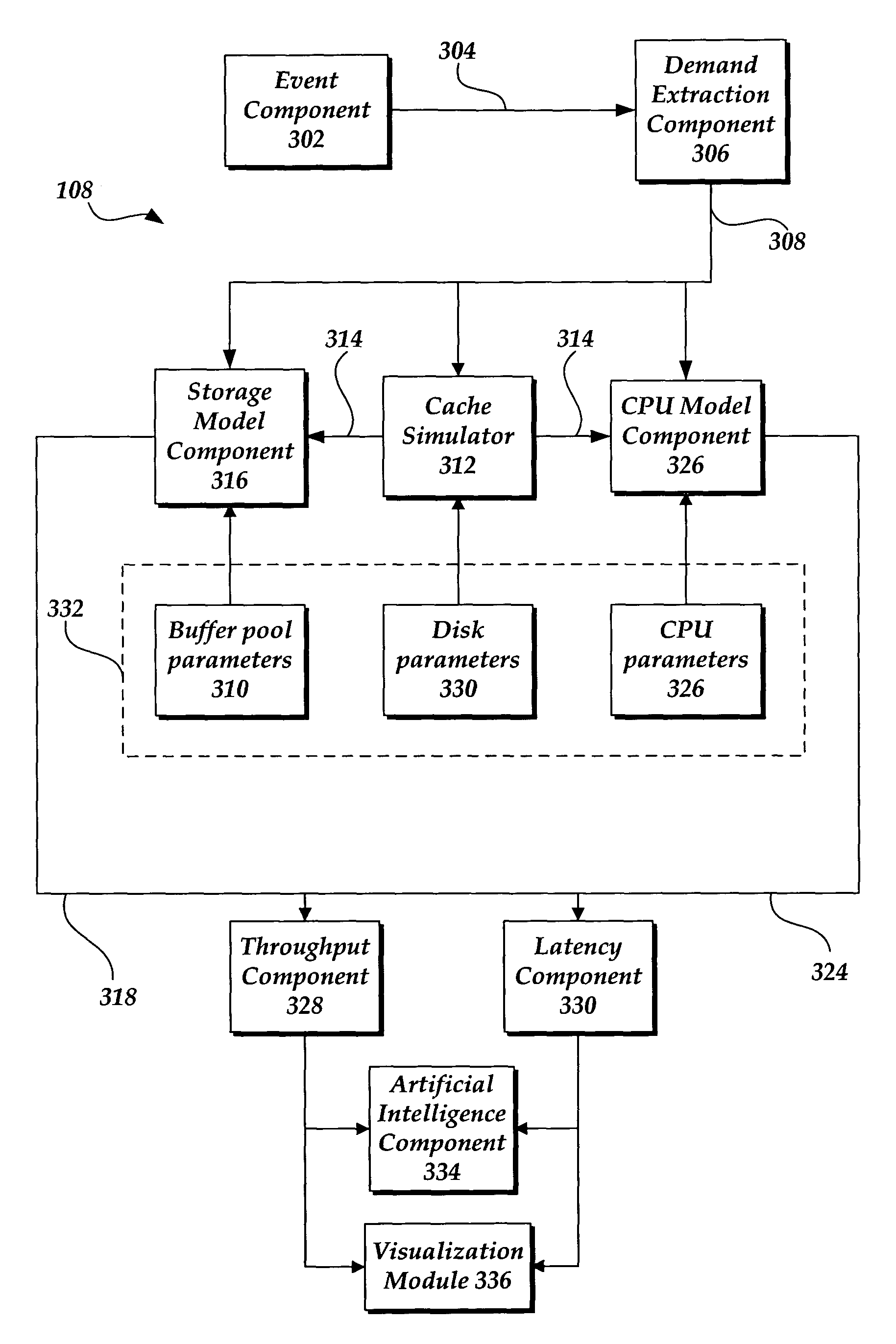

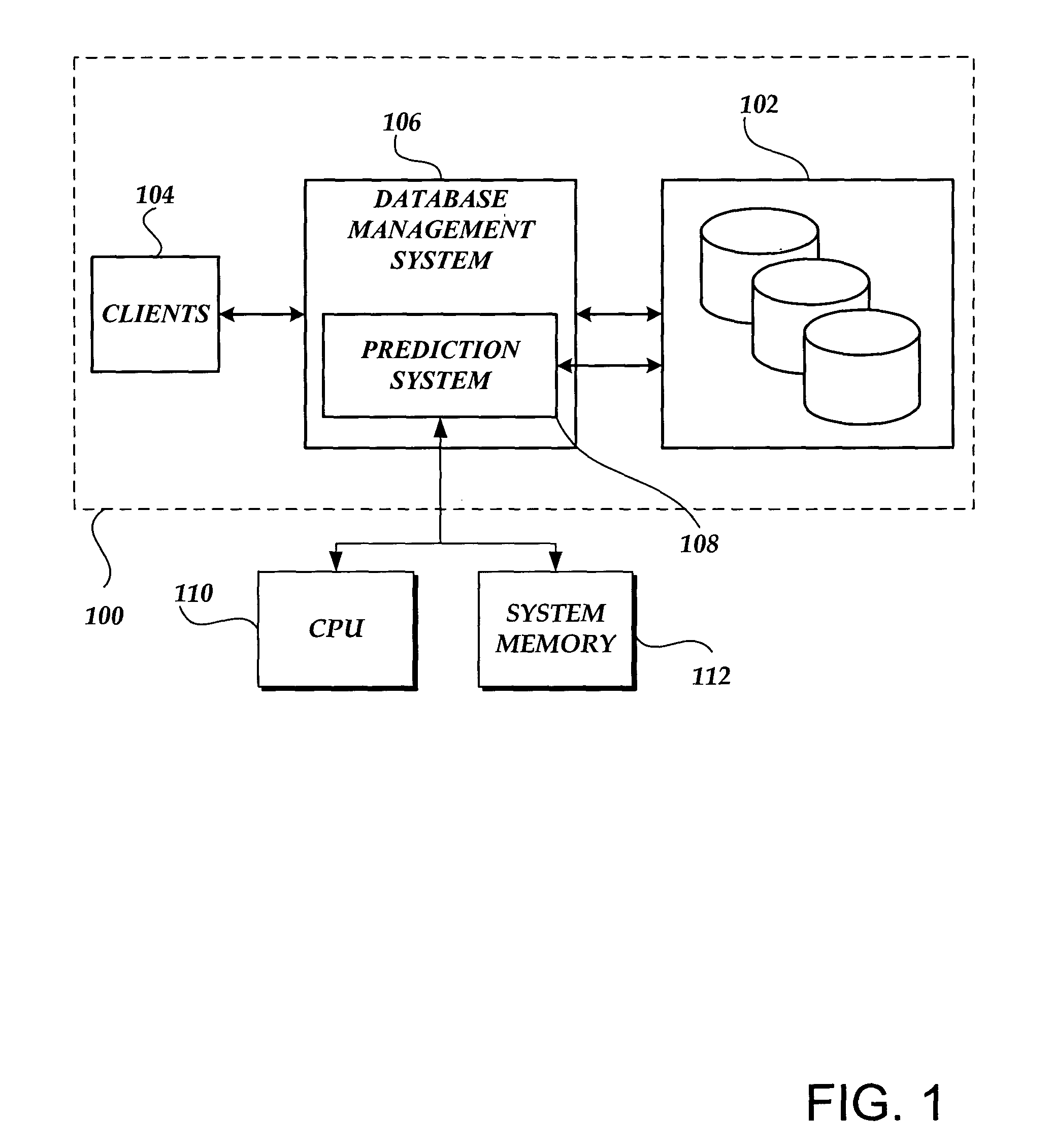

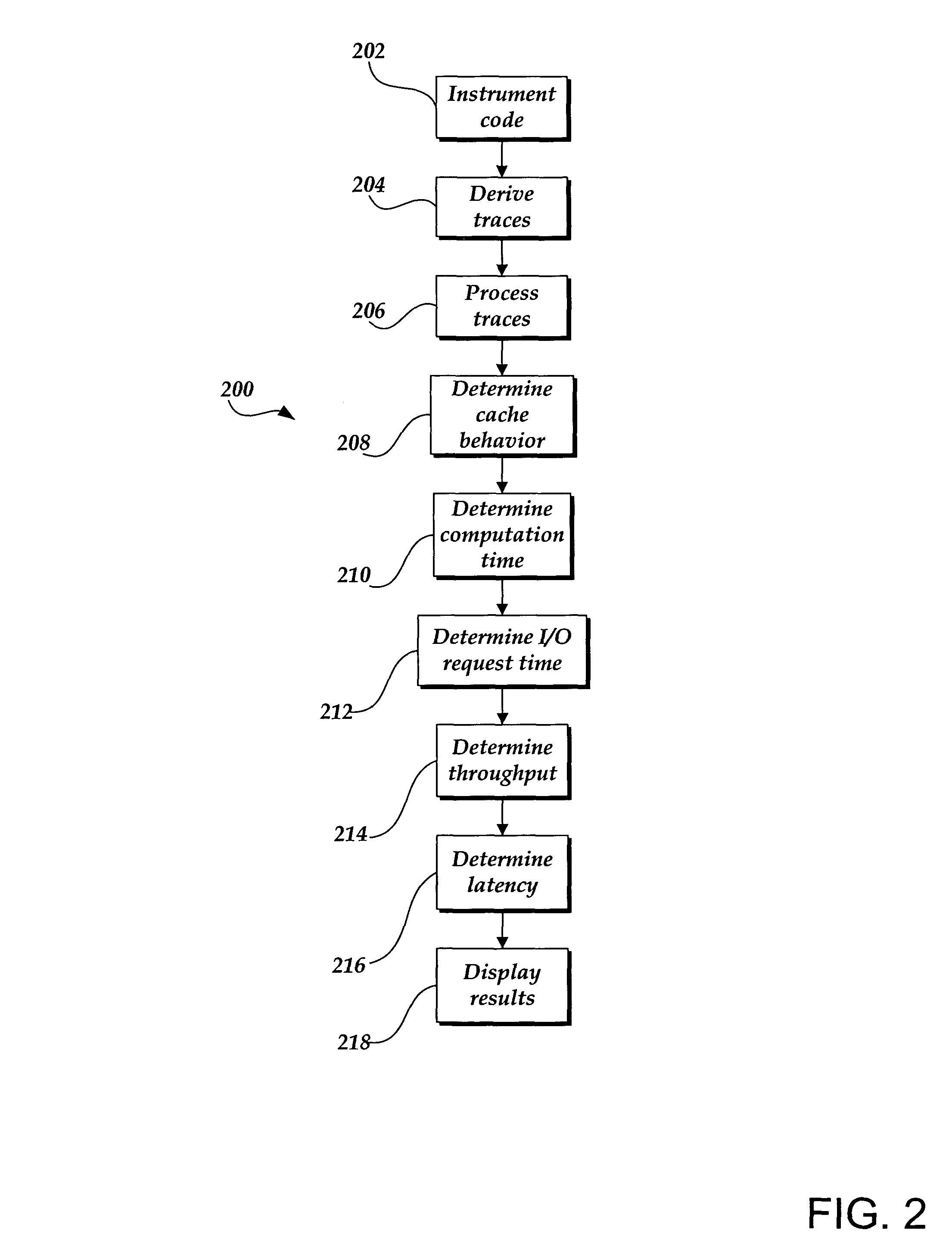

Predicting database system performance

ActiveUS8010337B2Reduce administrative burdenError detection/correctionDigital data processing detailsPrediction systemTransaction Type

A prediction system may perform capacity planning for one or more resources of a database systems, such as by understanding how different workloads are using the system resources and / or predicting how the performance of the workloads will change when the hardware configuration of the resource is changed and / or when the workload changes. The prediction system may use a detailed, low-level tracing of a live database system running an application workload to monitor the performance of the current database system. In this manner, the current monitoring traces and analysis may be combined with a simulation to predict the workload's performance on a different hardware configuration. More specifically, performance may be indicated as throughput and / or latency, which may be for all transactions, for a particular transaction type, and / or for an individual transaction. Database system performance prediction may include instrumentation and tracing, demand trace extraction, cache simulation, disk scaling, CPU scaling, background activity prediction, throughput analysis, latency analysis, visualization, optimization, and the like.

Owner:MICROSOFT TECH LICENSING LLC

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com