Patents

Literature

3209 results about "Monetary Amount" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

Monetary Amount. “Monetary amount" is the net amount of compensation including any allowances or post differential due an employee after making all deductions authorized by law, such as retirement or social security deductions, authorized allotments, Federal withholding tax, and others, when applicable.

Methods and apparatus for fairly placing players in bet positions

InactiveUS20050003878A1Data processing applicationsApparatus for meter-controlled dispensingComputer sciencePeer-to-peer

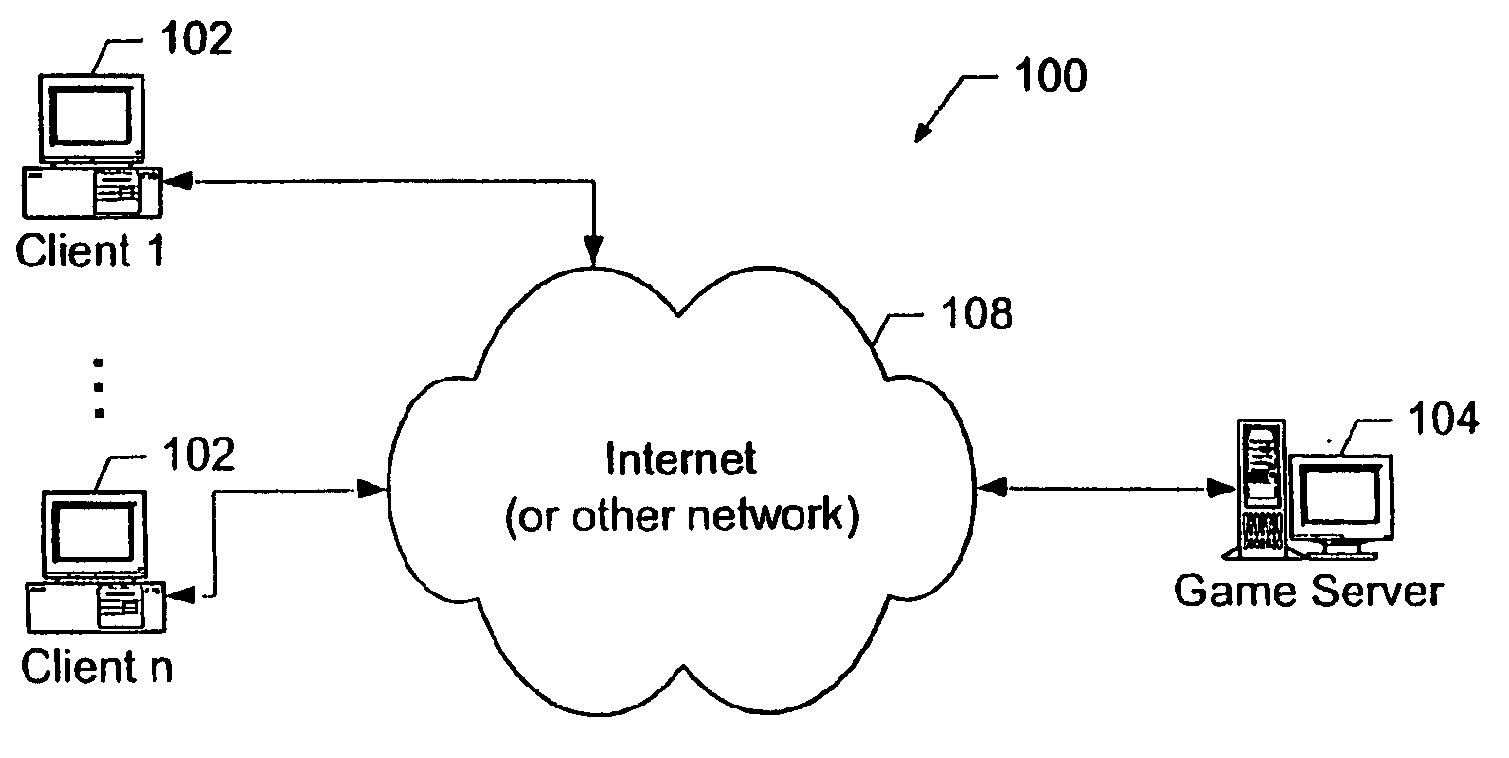

The apparatus and methods described herein facilitate fair peer-to-peer gambling. Generally, the system receives bet statement(s) from authorized player(s) and / or game administrator(s). Authorized players(s) then enter whole number percentages representing their beliefs that the outcome of the bet statement will be true. The players entering the risk percentages are encouraged to be as fair as possible, because players may be forced into undesirable bet positions. The amount of points or money wagered are then automatically determined based on the risk percentage(s). Once the actual outcome is determined, the winning player is rewarded in inverse proportion to his risk percentage.

Owner:UPDIKE KIM

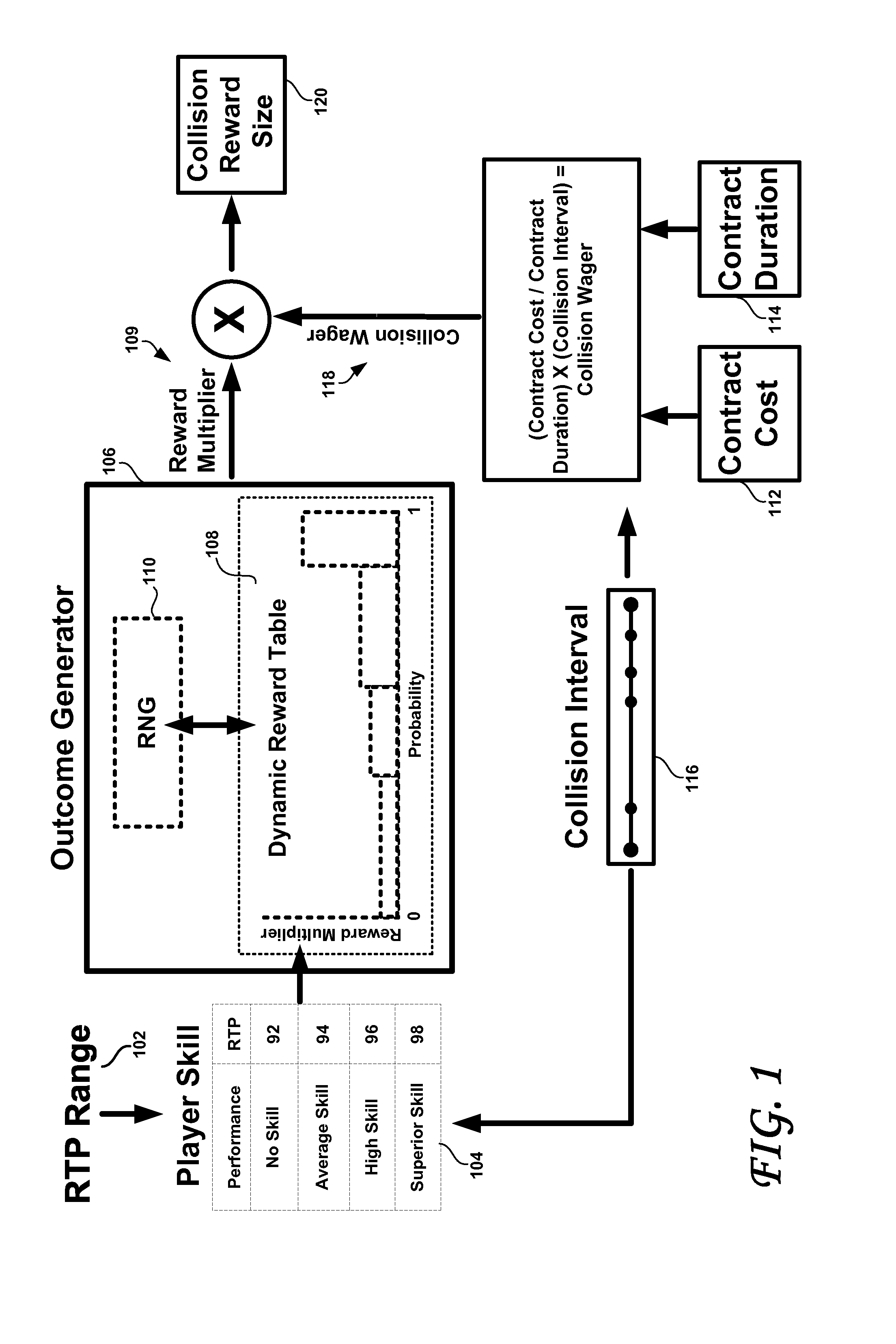

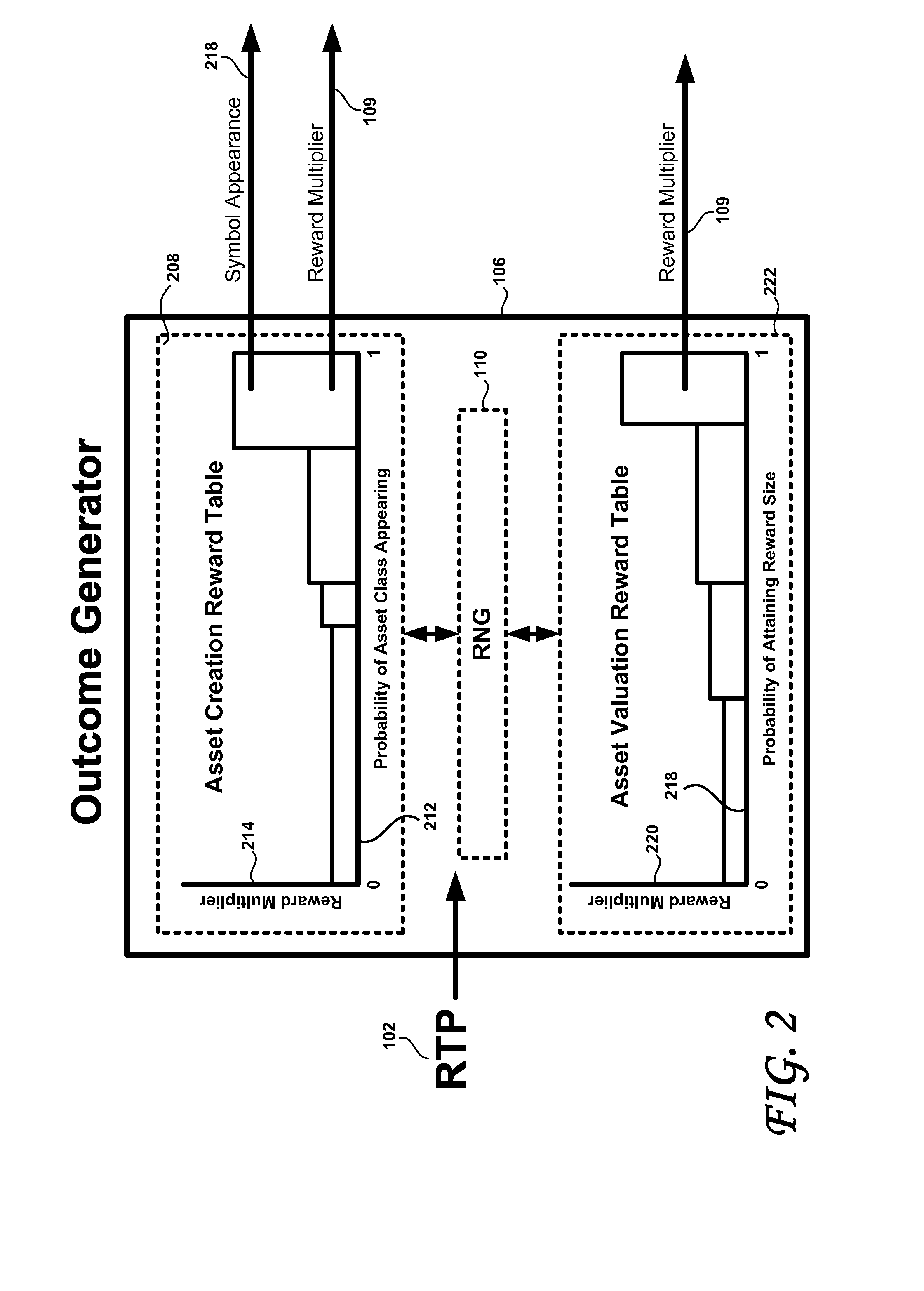

Return-driven casino game outcome generator

ActiveUS20090061999A1Positively affect their destinyHigh returnApparatus for meter-controlled dispensingVideo gamesReflexSkill sets

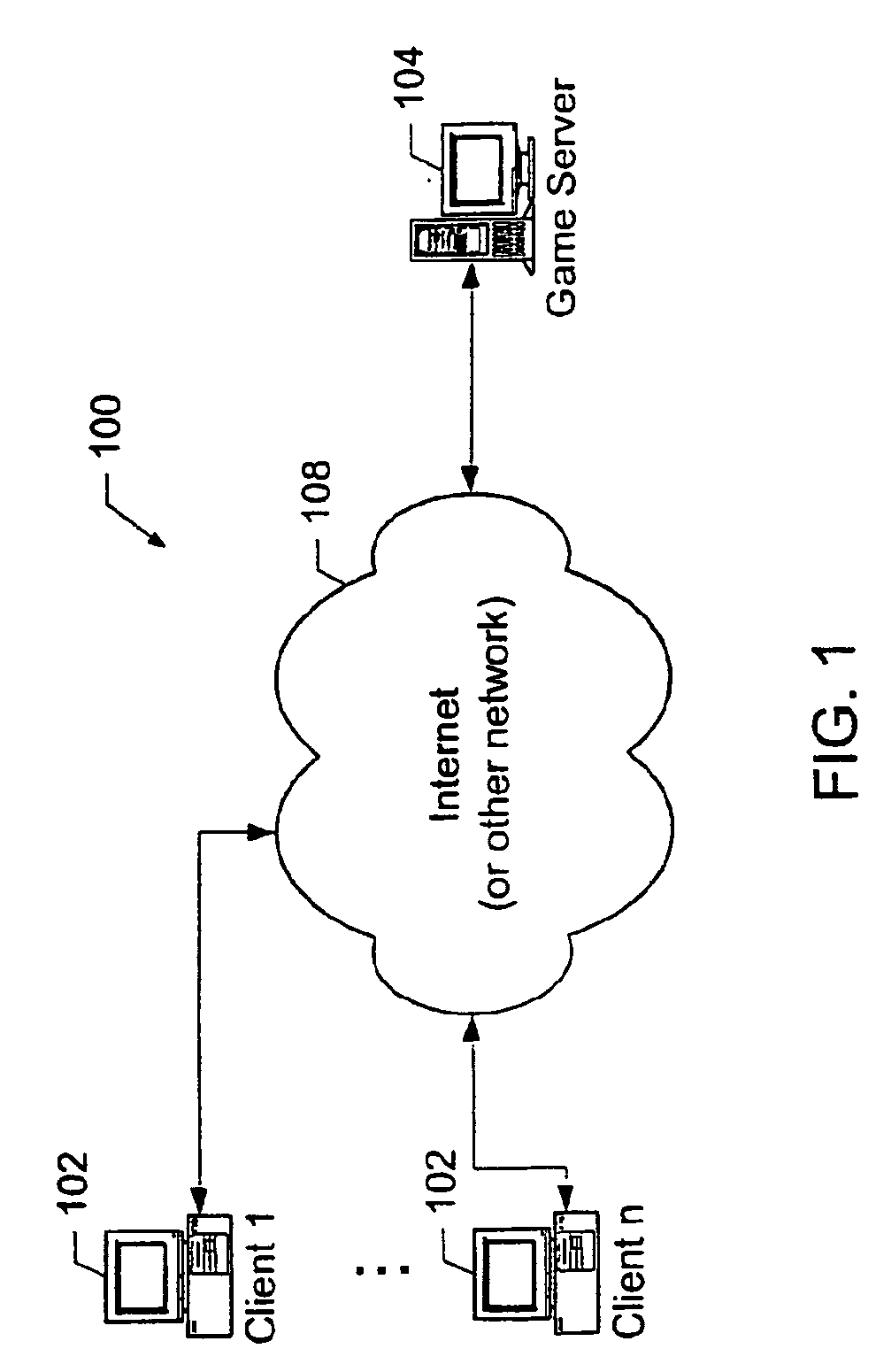

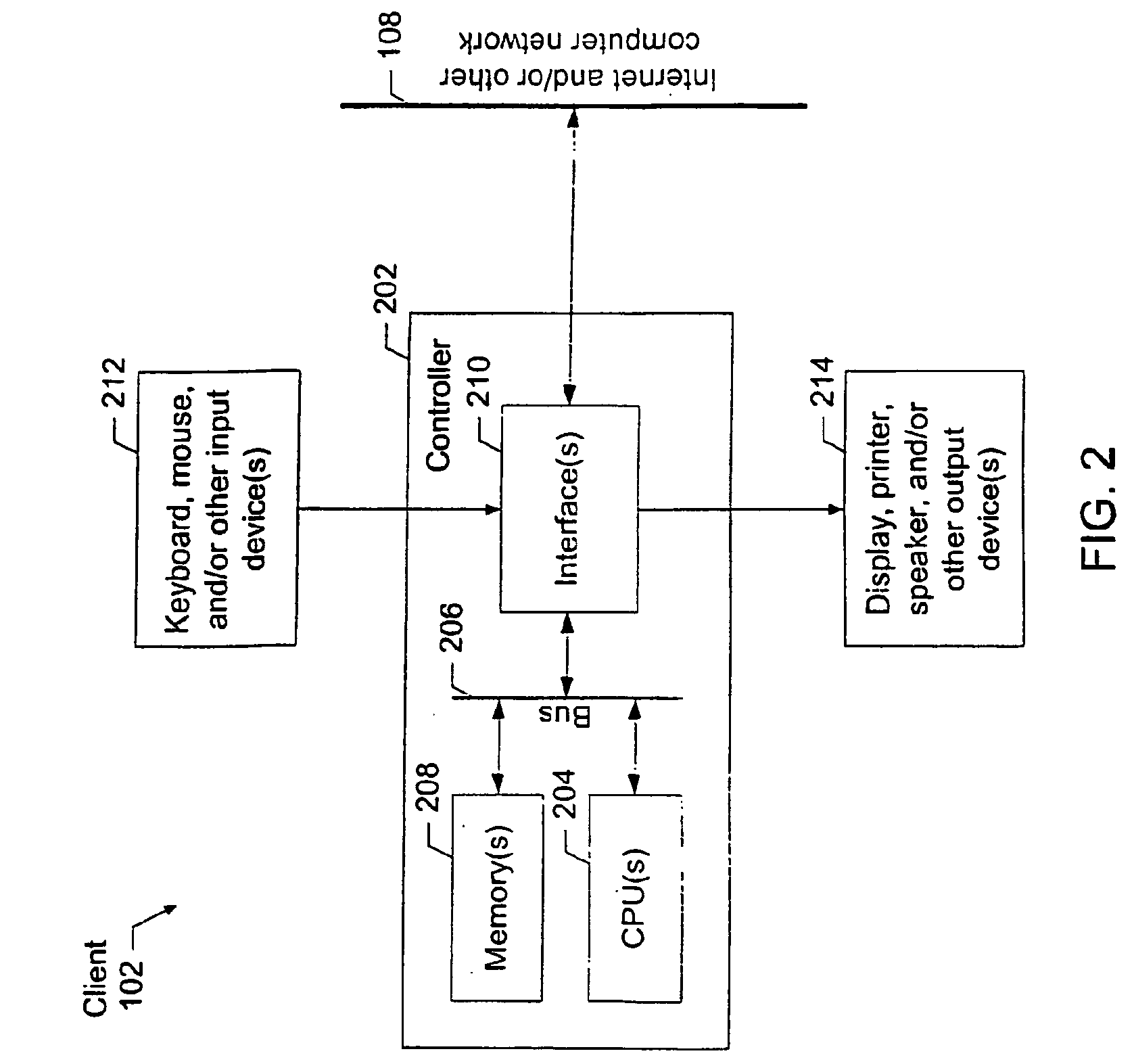

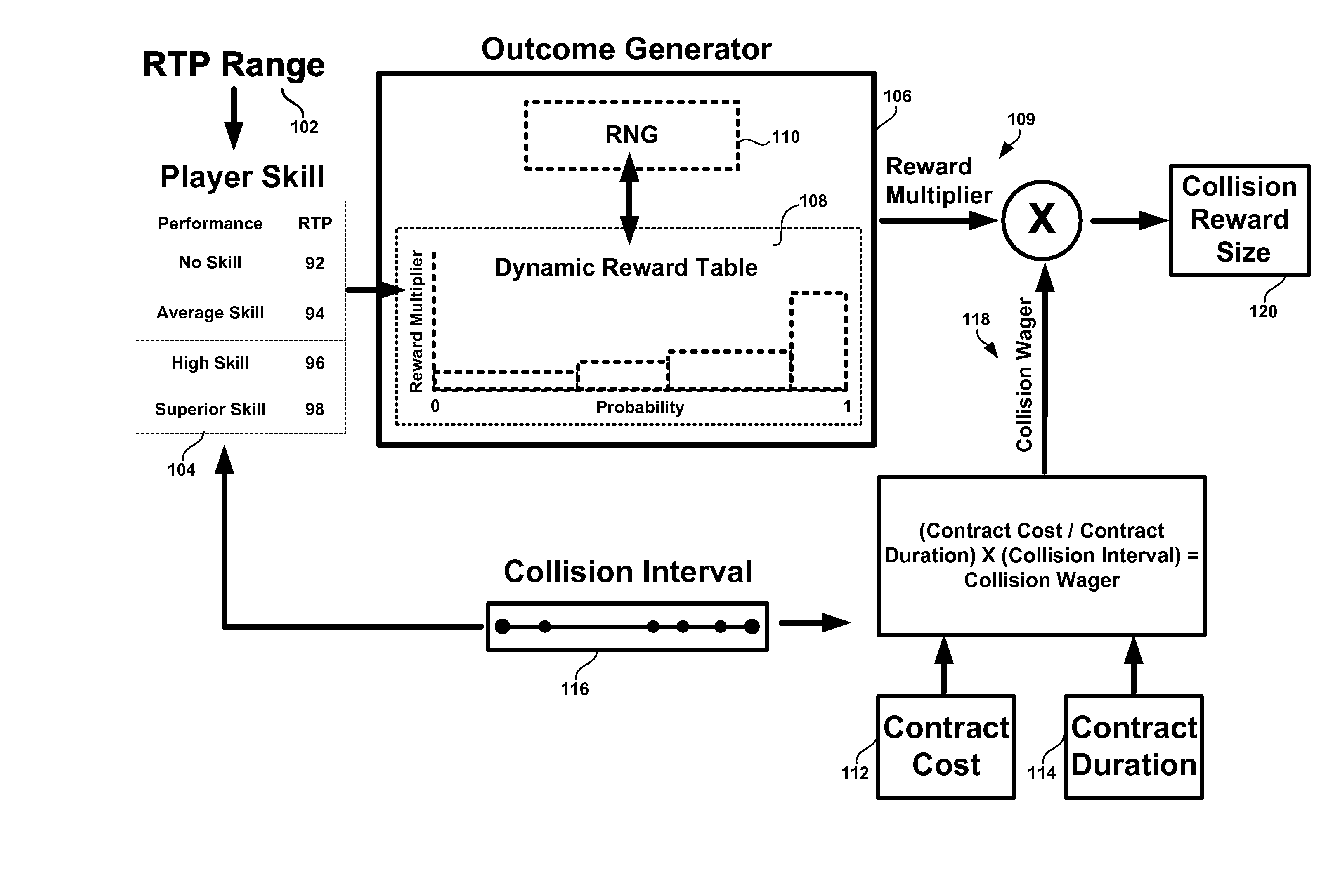

The Return Driven Casino Game Outcome Generator makes the first true class of casino video game possible by creating games that measure and reward skills like fast reflexes and manual dexterity while earning consistent and reliable profits for game operators. An embodiment of a method incorporating RDOG may include steps of requiring a player to purchase a predetermined amount of playing time for a predetermined amount of money; inputting an initial average Return-To-Player (RTP) percentage of the regulated game; initiating the regulated game, and during the purchased predetermined amount of playing time: providing a plurality of reward generating assets and enabling the player to interact therewith, a successful interaction with a reward generating asset generating a reward for the player, and providing a plurality of time penalty inducing assets, interaction with one of which imposes a predetermined time penalty during which the player is prevented from interacting with any of the plurality of reward generating assets whereby, after interaction with one of the plurality of penalty inducing assets, the initial average RTP percentage is reduced by an amount proportional to a length of the predetermined time penalty.

Owner:IGT

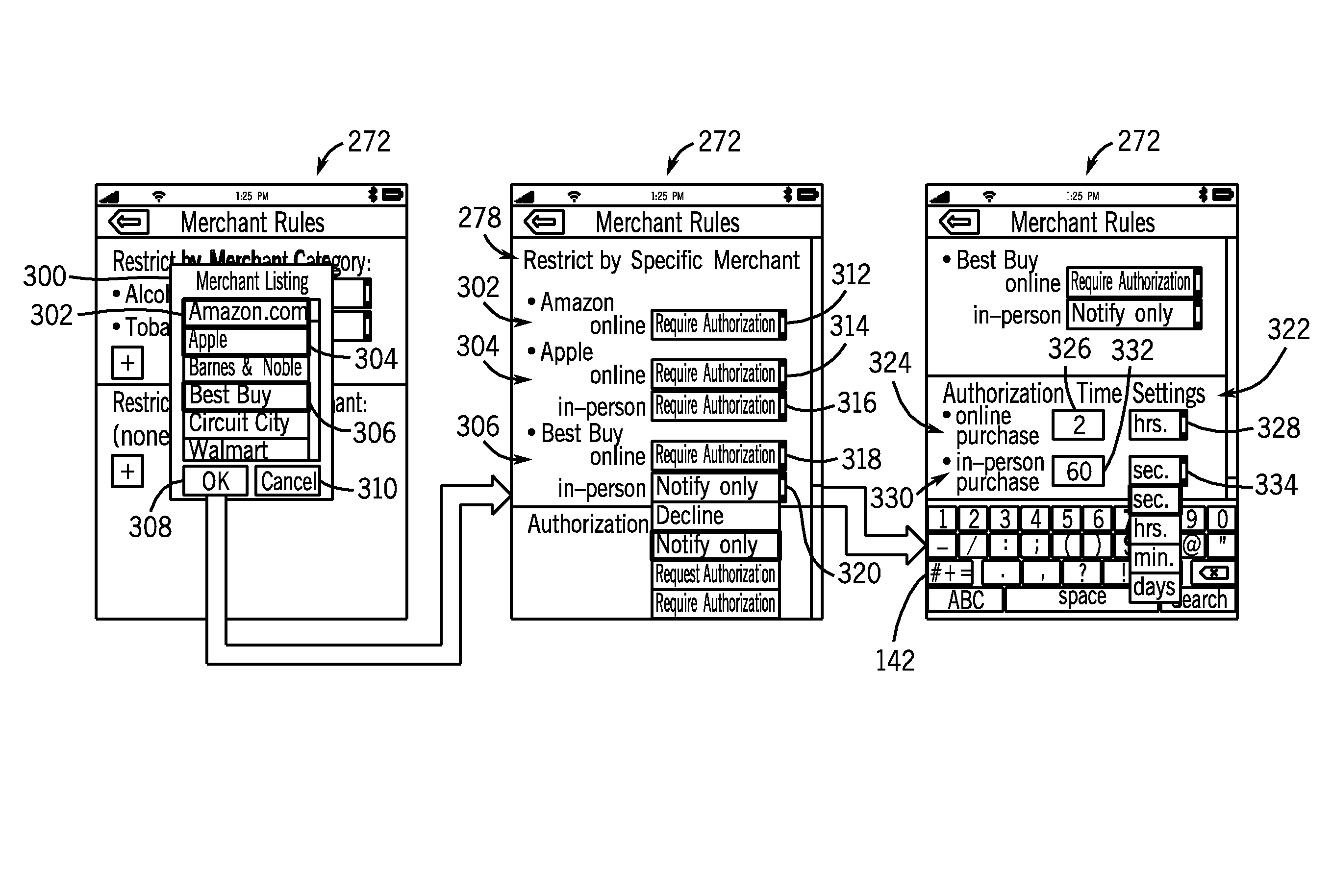

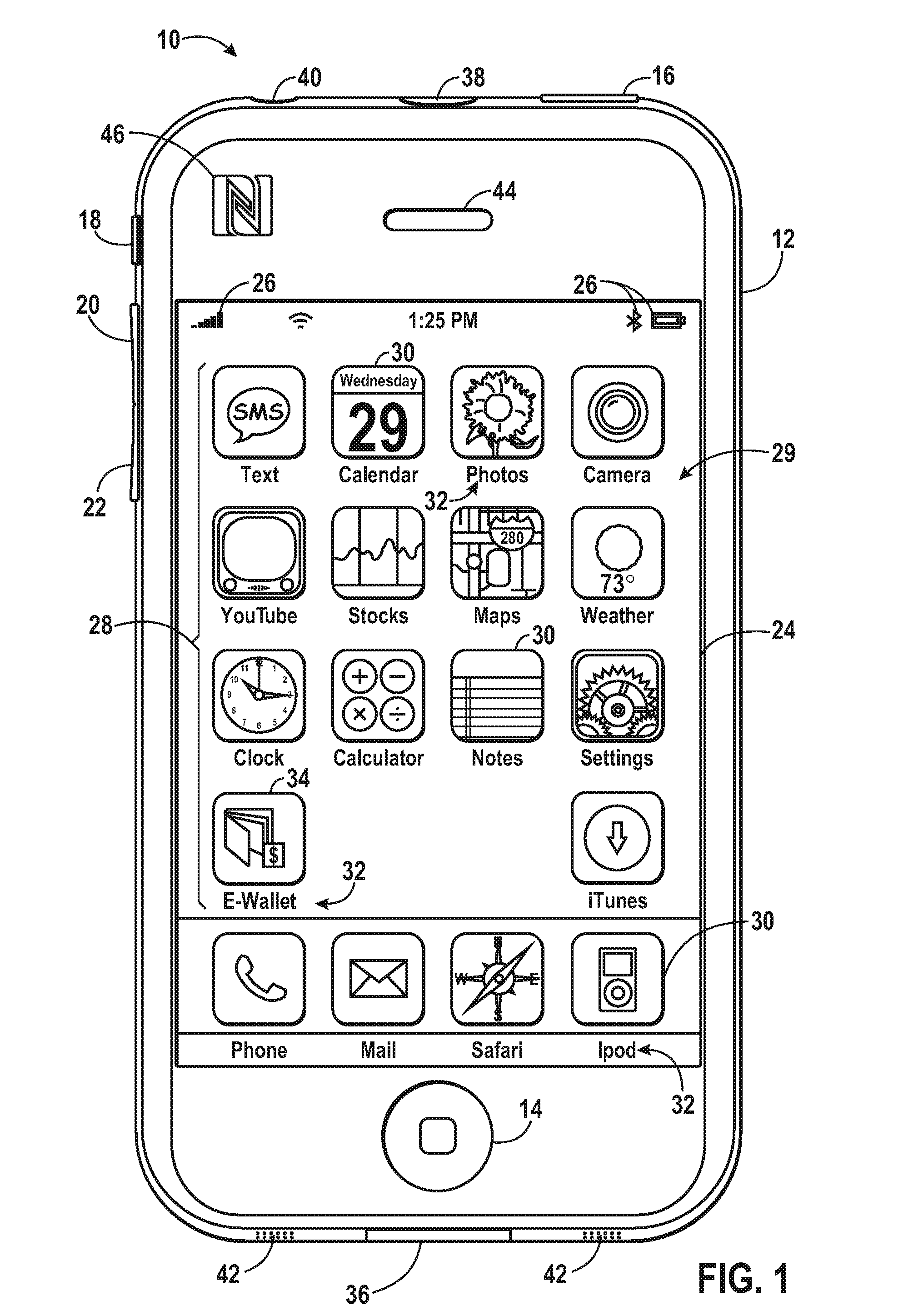

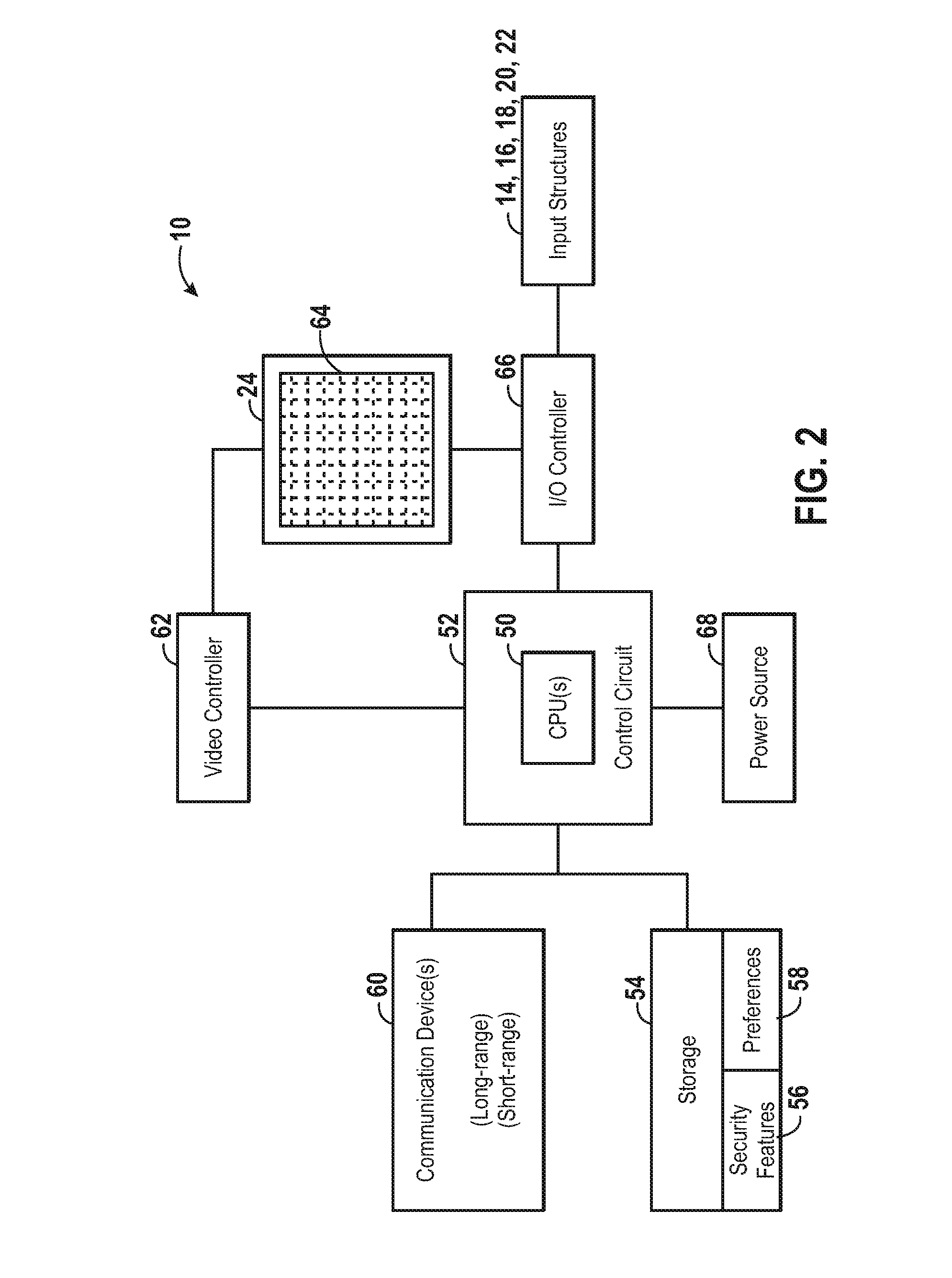

Parental controls

Various techniques are provided for establishing financial transaction rules to control one or more subsidiary financial accounts. In one embodiment, a financial account management application stored on a processor-based device may provide an interface for defining financial transaction rules to be applied to a subsidiary account. The financial transaction rules may be based upon transaction amounts, aggregate spending amounts over a period, merchant categories, specific merchants, geographic locations, or the like. The device may update the financial transaction rules associated with a subsidiary account by communicating the rules to an appropriate financial server. Accordingly, transactions made using the subsidiary account by a subsidiary account holder may be evaluated against the defined rules, wherein an appropriate control action is carried out if a financial transaction rule is violated.

Owner:APPLE INC

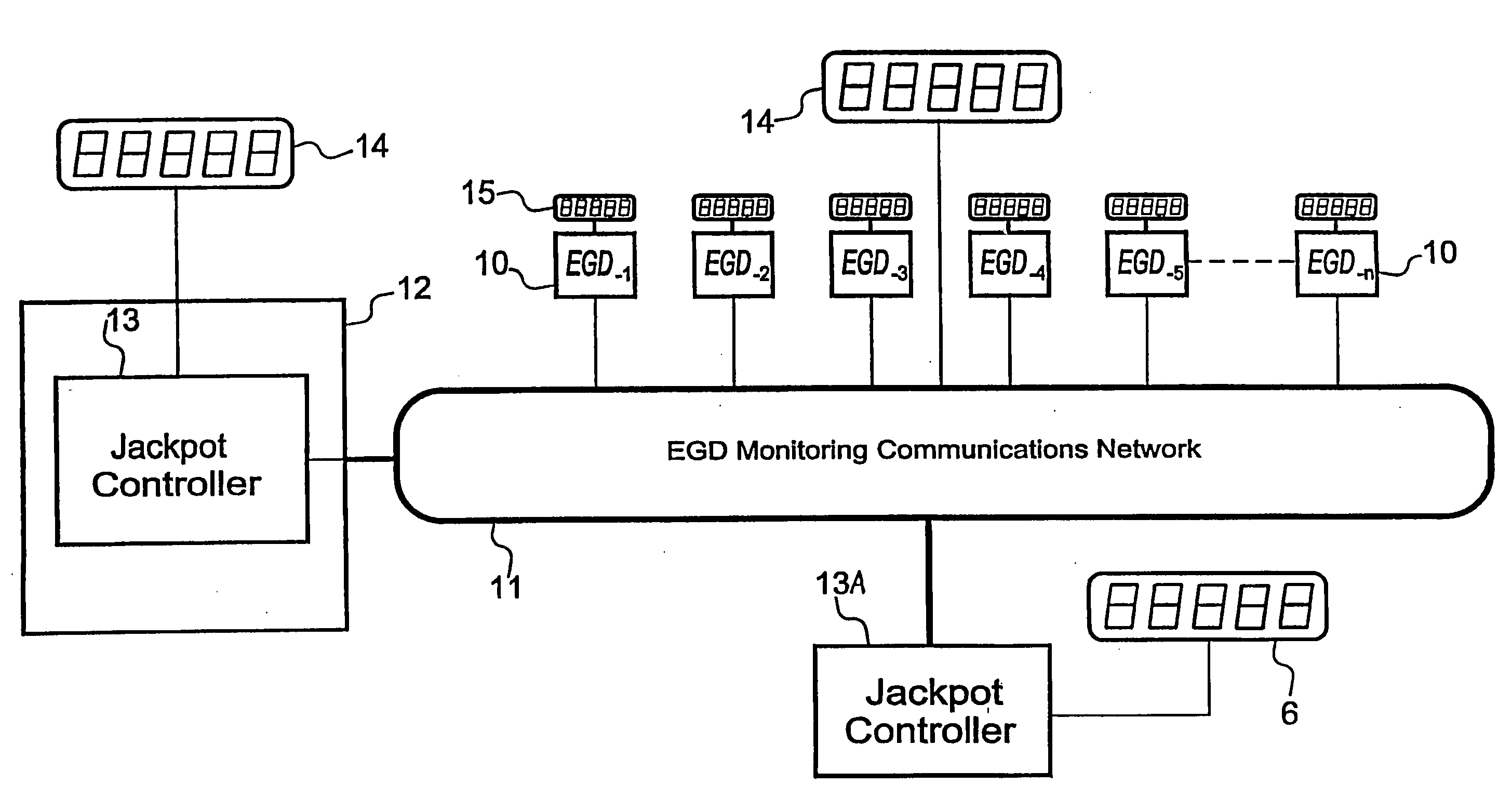

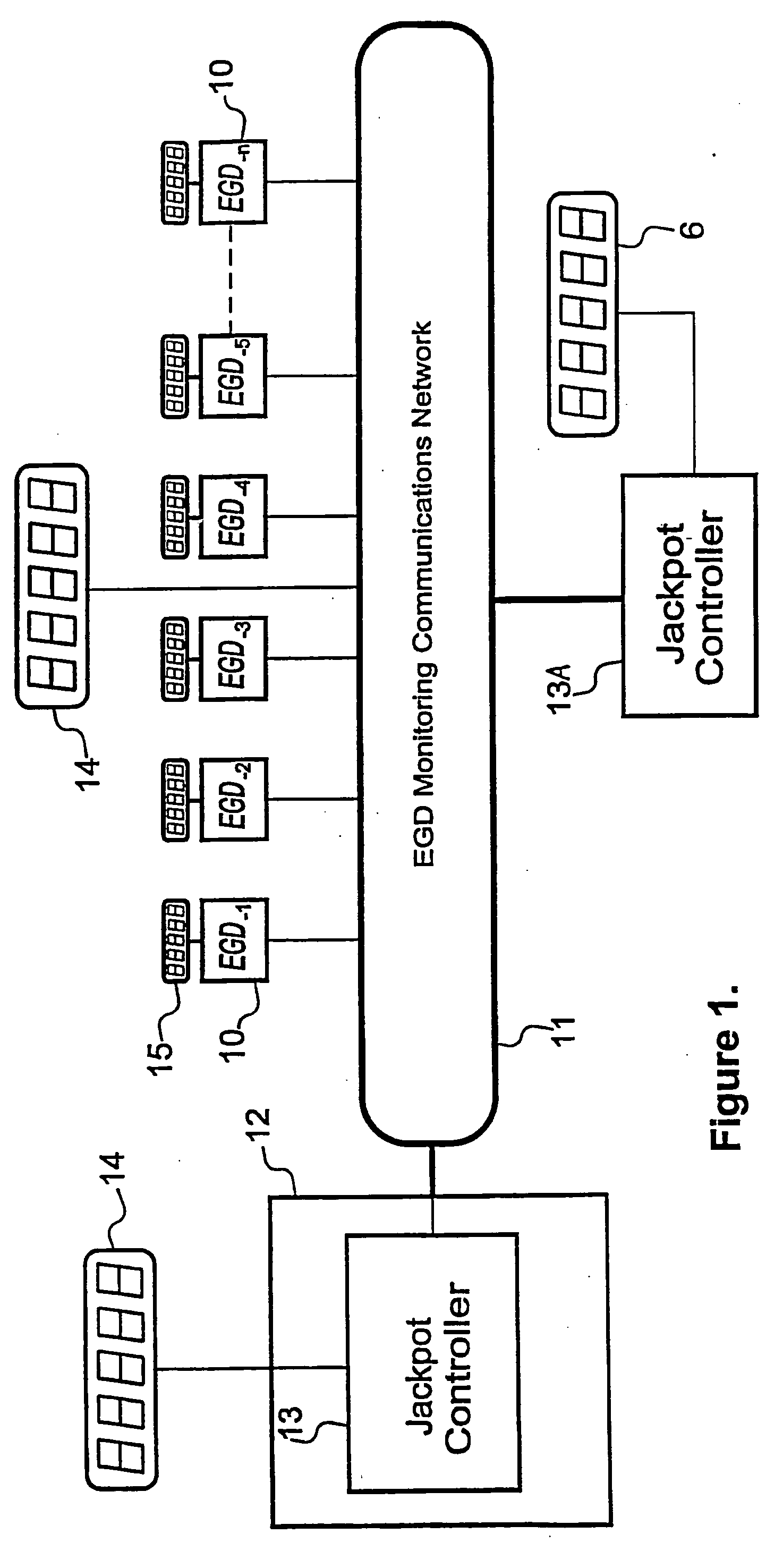

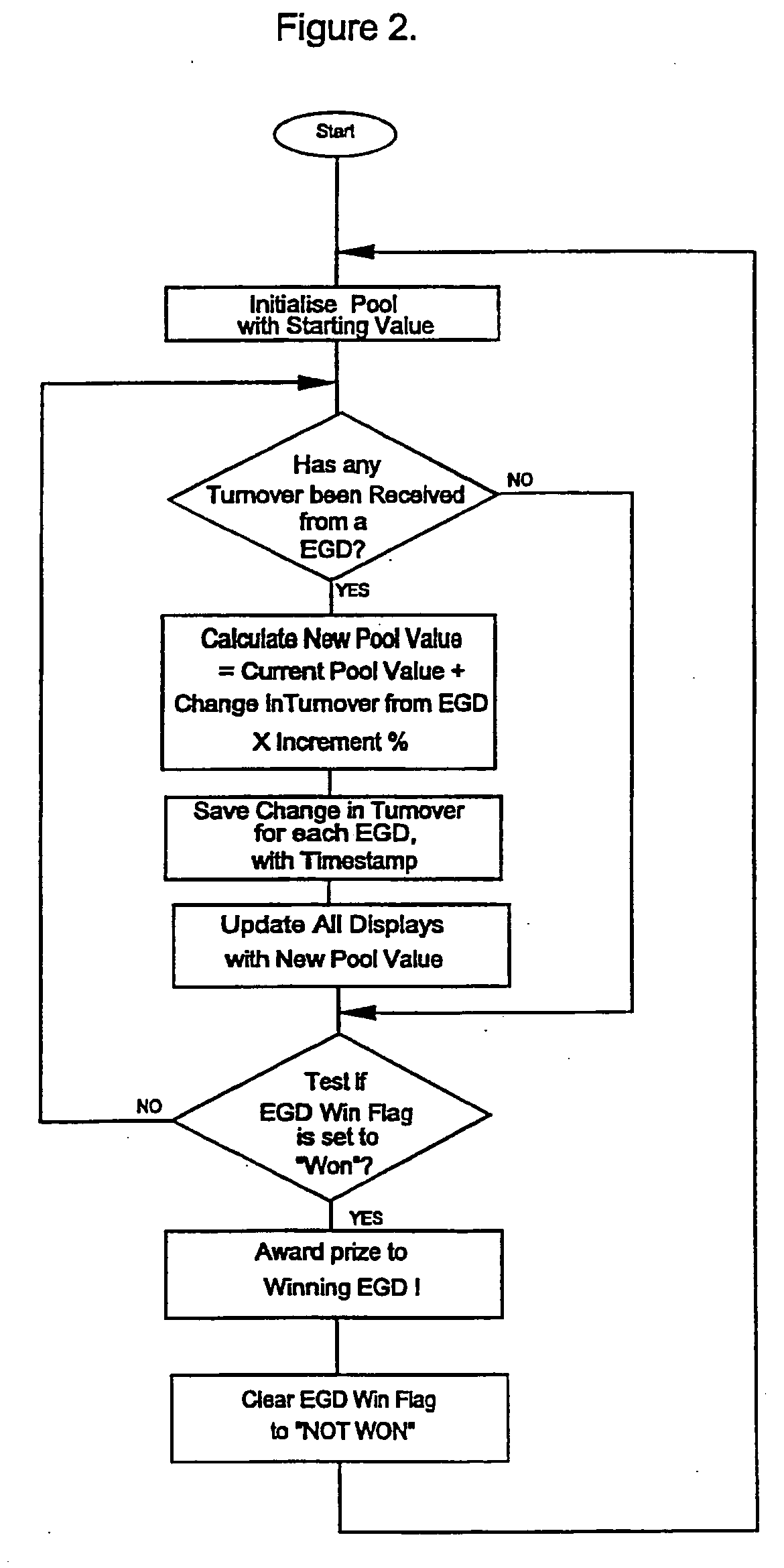

Method of awarding prizes for jackpot and gaming machines based on amount wagered during a time period

InactiveUS20060025210A1Fully understandApparatus for meter-controlled dispensingVideo gamesAWARDS PRIZESEngineering

Periodic prize draws are conducted by a jackpot controller (13) in a gaming system having one or more electronic gaming devices (10). The probability of each electronic gaming device winning a particular prize draw is dependent upon the amount wagered on that gaming machine during a period preceding that prize draw. The prize may be a progressive jackpot which comprises an initial starting value and a contribution from the amounts wagered on the electronic gaming devices. If an electronic gaming device wins a prize draw, its player may be granted a feature game to determine the actual prize. Jackpots are suspended pending the completion of the feature game. The probability that a gaming device will win the prize draw, or the relative win probabilities of the gaming devices, may be displayed graphically.

Owner:IGT

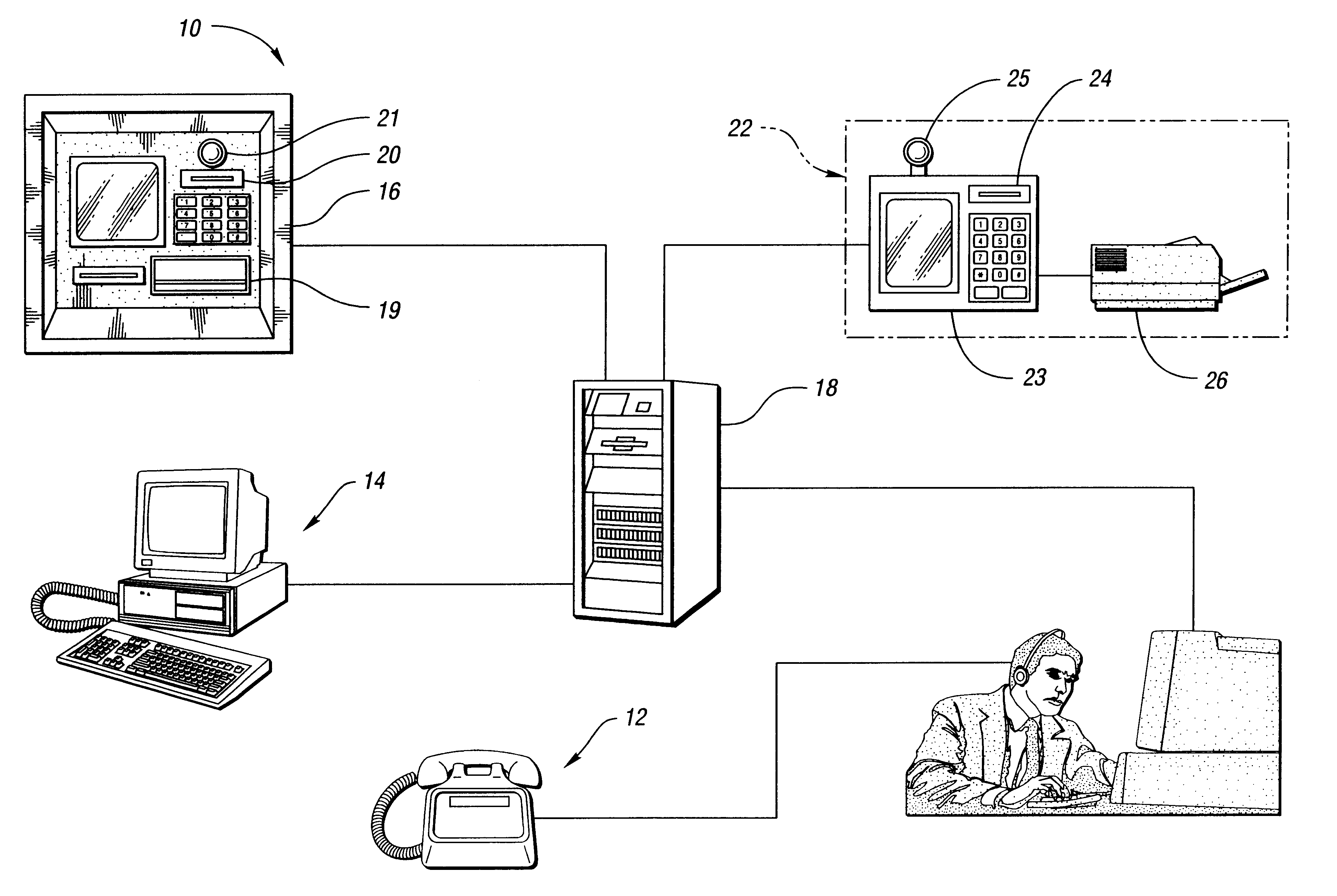

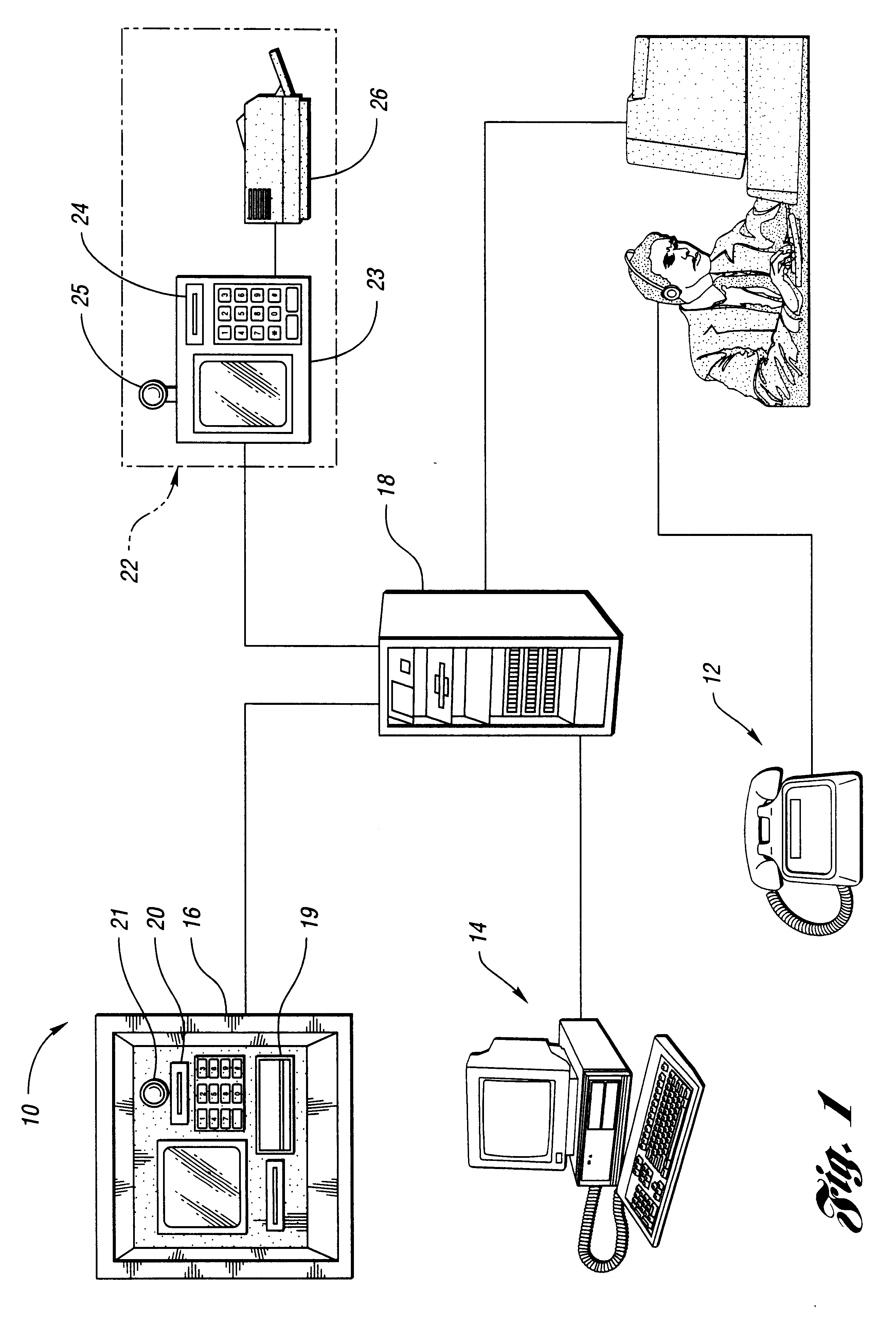

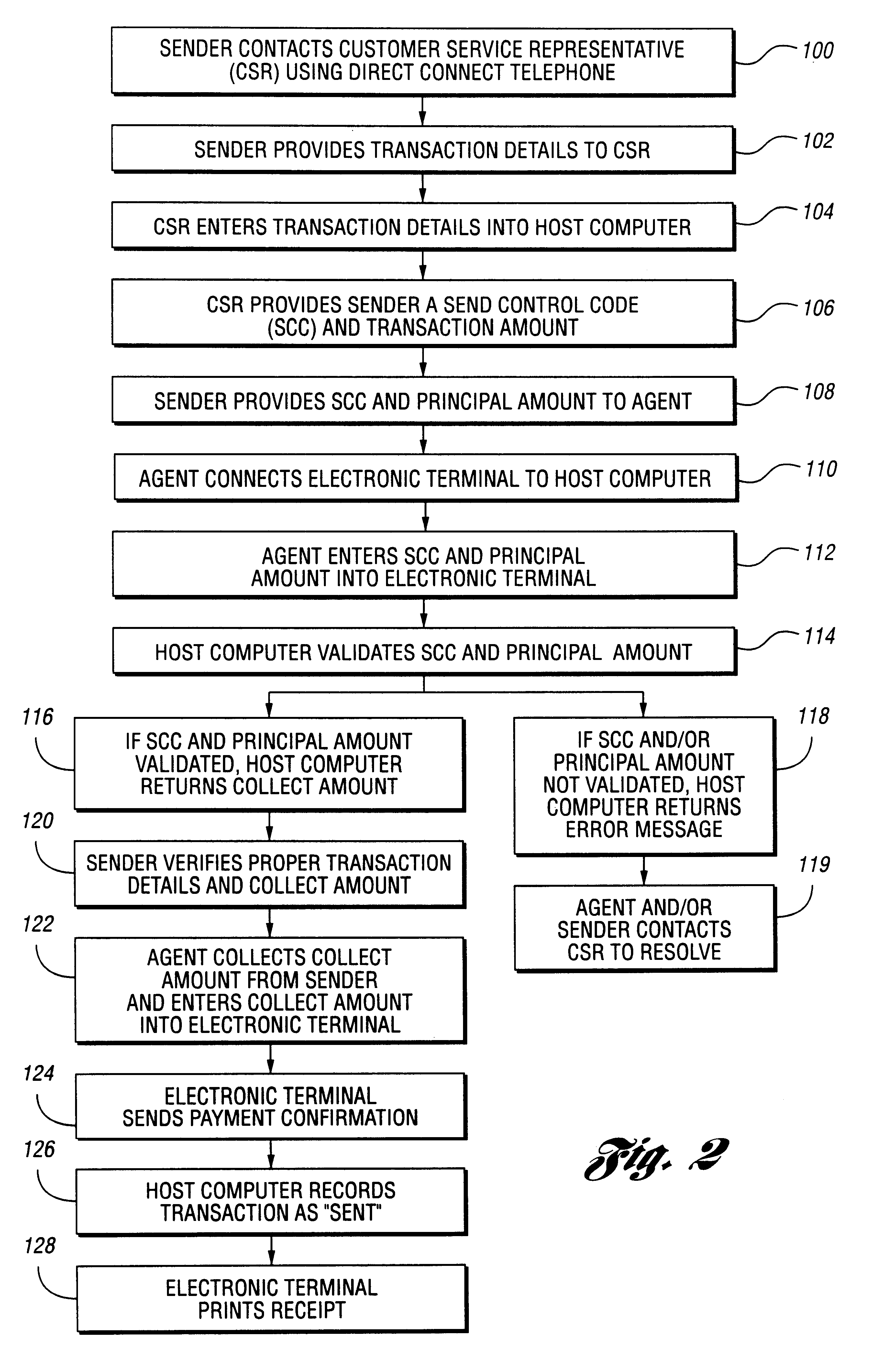

Method and system for performing money transfer transactions

InactiveUS6488203B1Shorten transaction timeImprove accuracyComplete banking machinesFinanceComputer scienceDatabase

A method of performing a send money transfer transaction through a financial services institution includes storing transaction details on a data base, wherein the transaction details include a desired amount of money to be sent; establishing a code that corresponds to the transaction details stored on the data base; entering the code into an electronic transaction fulfillment device in communication with the data base to retrieve the transaction details from the data base; and determining a collect amount based on the transaction details. A system for performing a send money transfer transaction is also disclosed.

Owner:THE WESTERN UNION CO

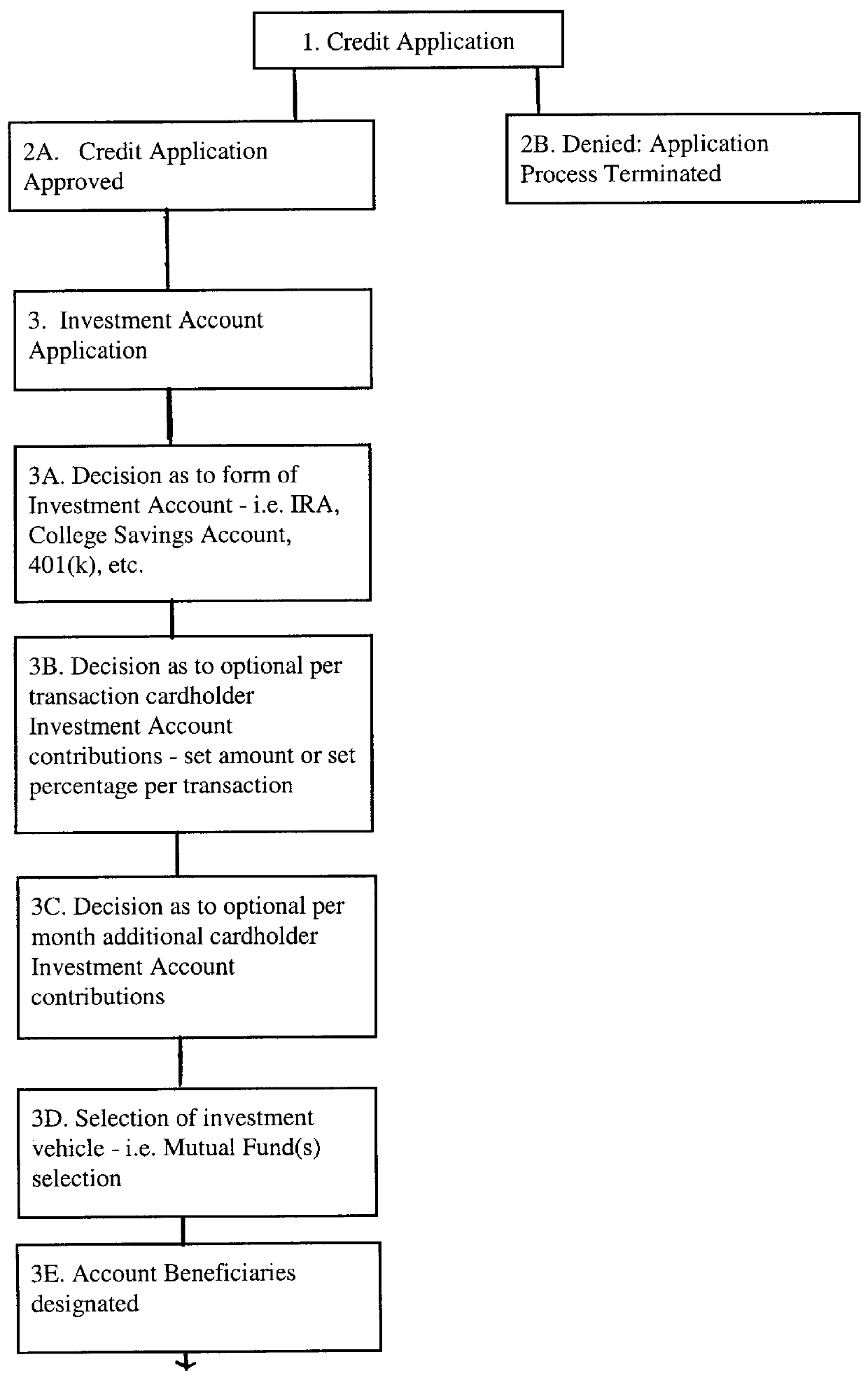

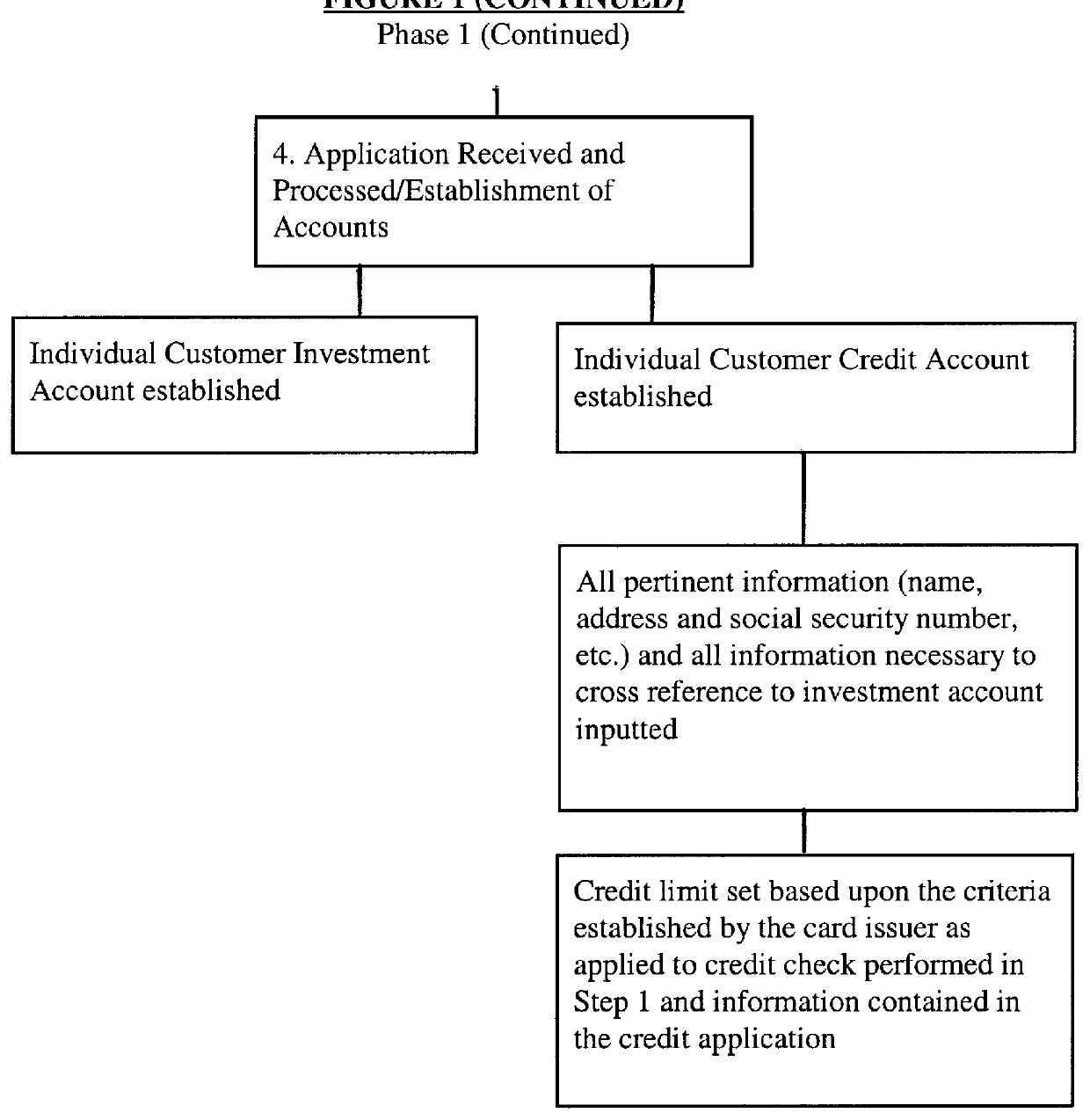

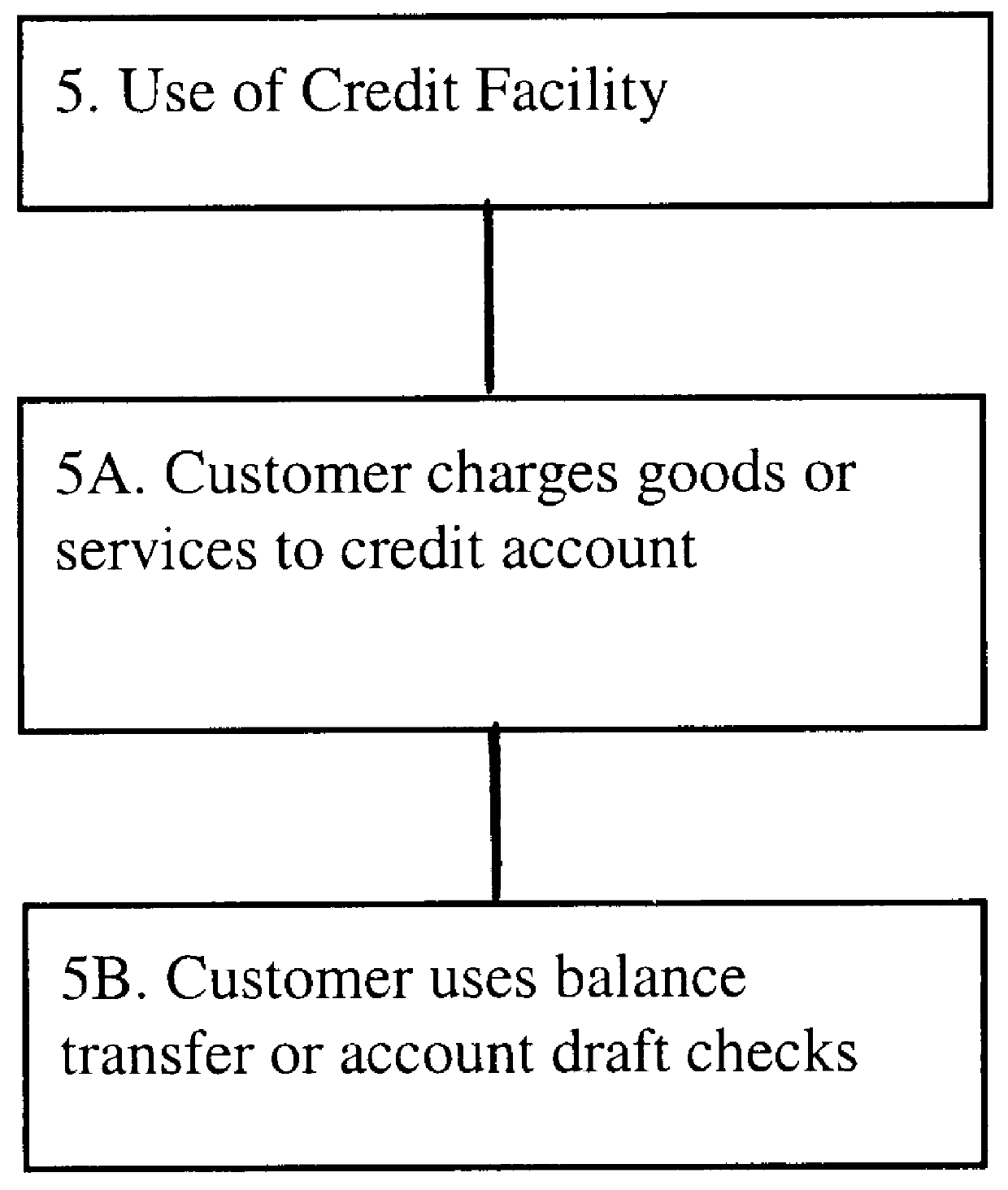

System and method for automatically investing a portion of a credit card interest charged amount in an investment account

InactiveUS6070153ASolve low usageLow savingComplete banking machinesFinanceCredit card interestCollege education

A system and methods for automatically investing, a portion of interest charged amount paid by the card issuer or the cardholder, on a credit card account, to an individual retirement account, taxpayer relief act of 1997 IRA, "Roth Act" or "Super IRA", college education IRA or spousal IRA (herein, collectively, "IRA"), college savings account, 401(K) plan (with or without linkage to a company expense account credit card), dividend reinvestment program (in stock of the card issuing company or otherwise) or other investment feature.

Owner:SIMPSON MARK S

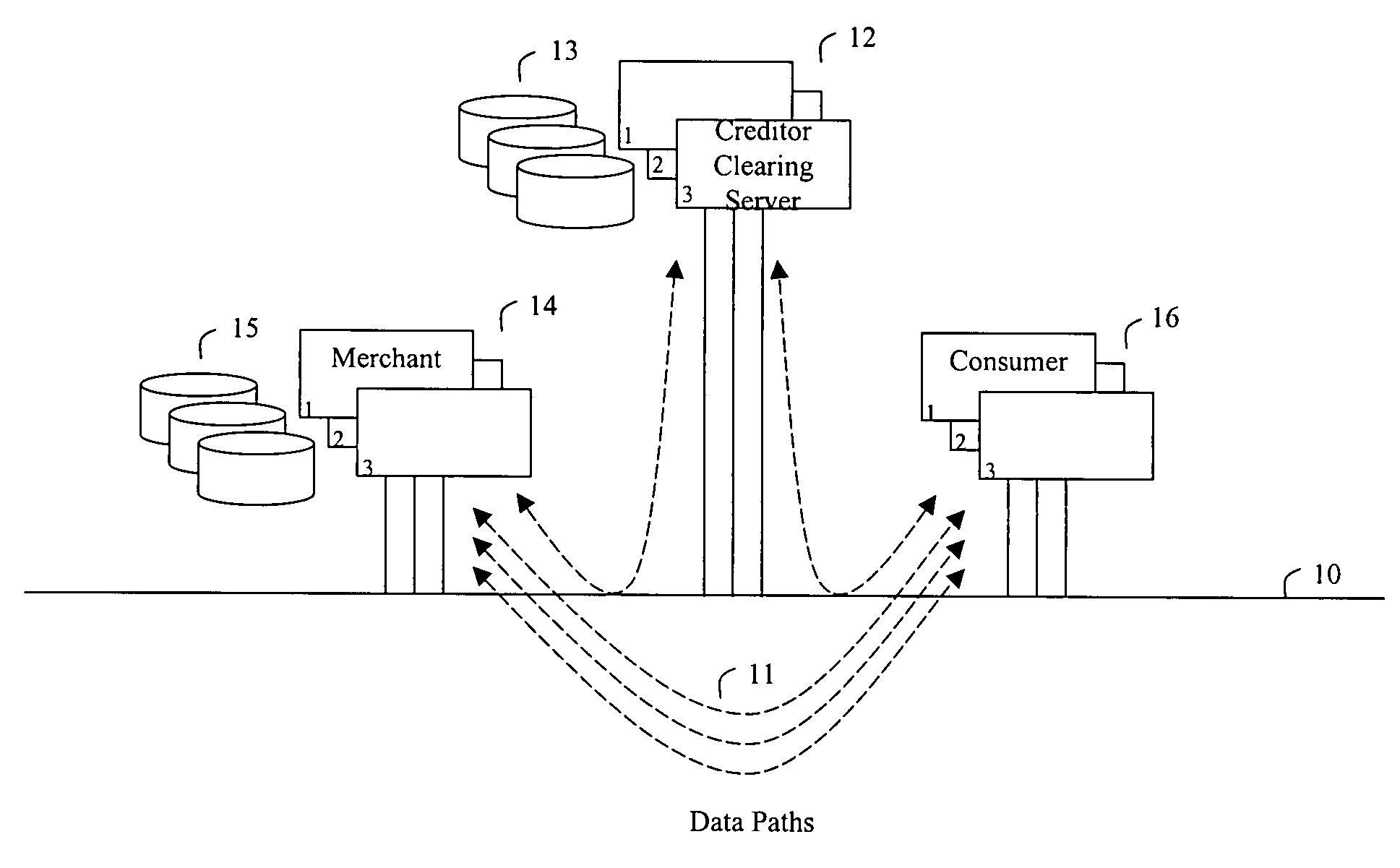

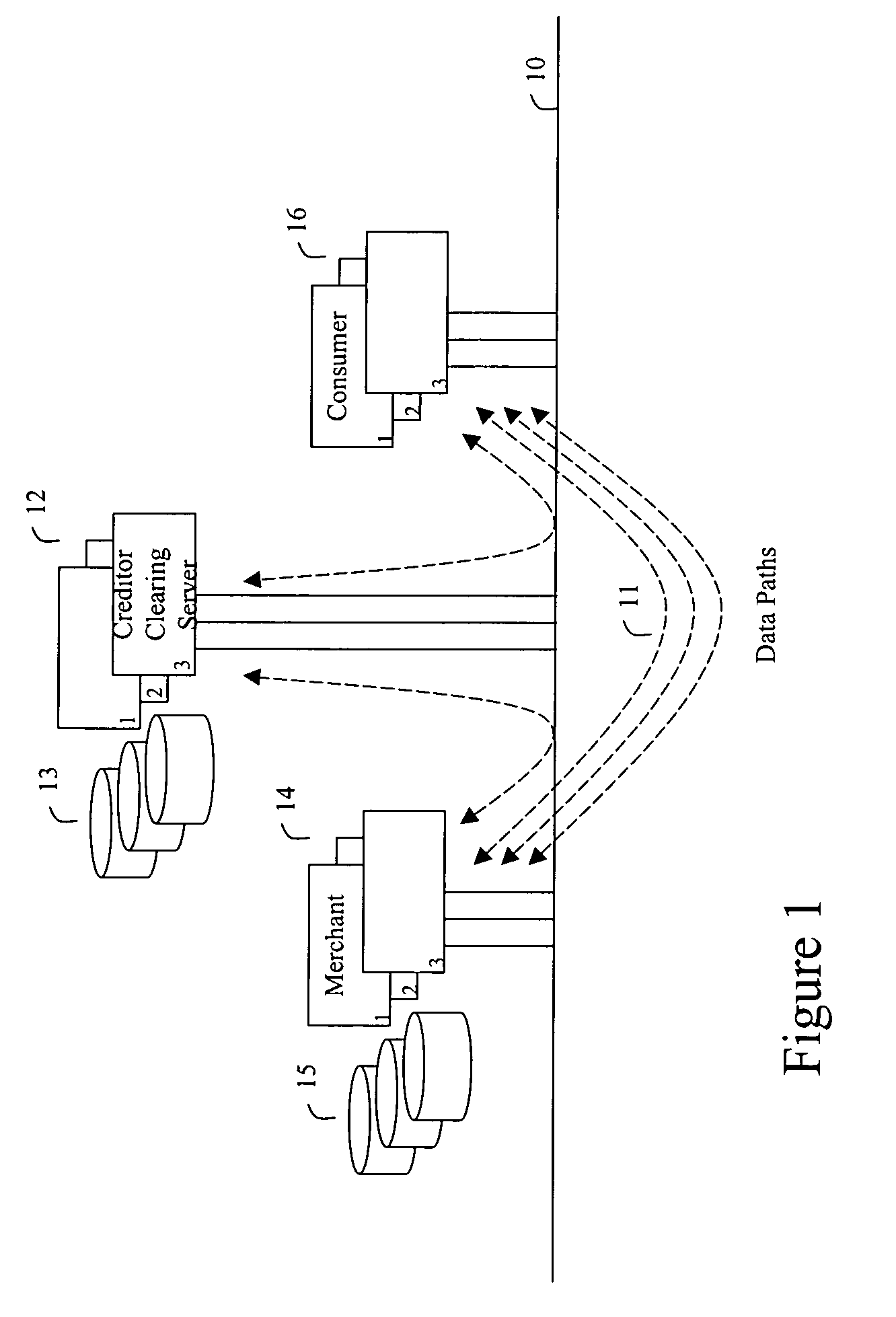

Method and apparatus for making secure electronic payments

In accordance with the present invention, consumers and merchants use computing devices connected to a network, such as the Internet, through wired and wireless means, wherein the consumer connects to a clearing server device to purchase or retrieve previously purchased token, the consumer then connects to the merchant's computer or website to attain price quotes of goods and services, selects the goods and / or services to be purchased, and then communicates a request for purchase to the merchant. The merchant then communicates a request for an update key to the clearing server. The update key is used as an authorization to modify the value of the token. To debit the customer the decrement key is requested and to credit the customer an increment key is asked for. An overwrite key is another type of update key. Together with the overwrite key a replacement token is provided to the merchant who in turn forwards the new token to the customer. As an aspect of the invention, if the token was not previously used, the clearing server simply issues the update key. If, however, it is determined that the token was used, the amount paid by the consumer to a previous merchant is determined the token adjusted and the overwrite key together with the new token is returned to the merchant. The merchant then forwards the purchased merchandise, the update key, and possibly a new token to the consumer.

Owner:AMPACASH CORP

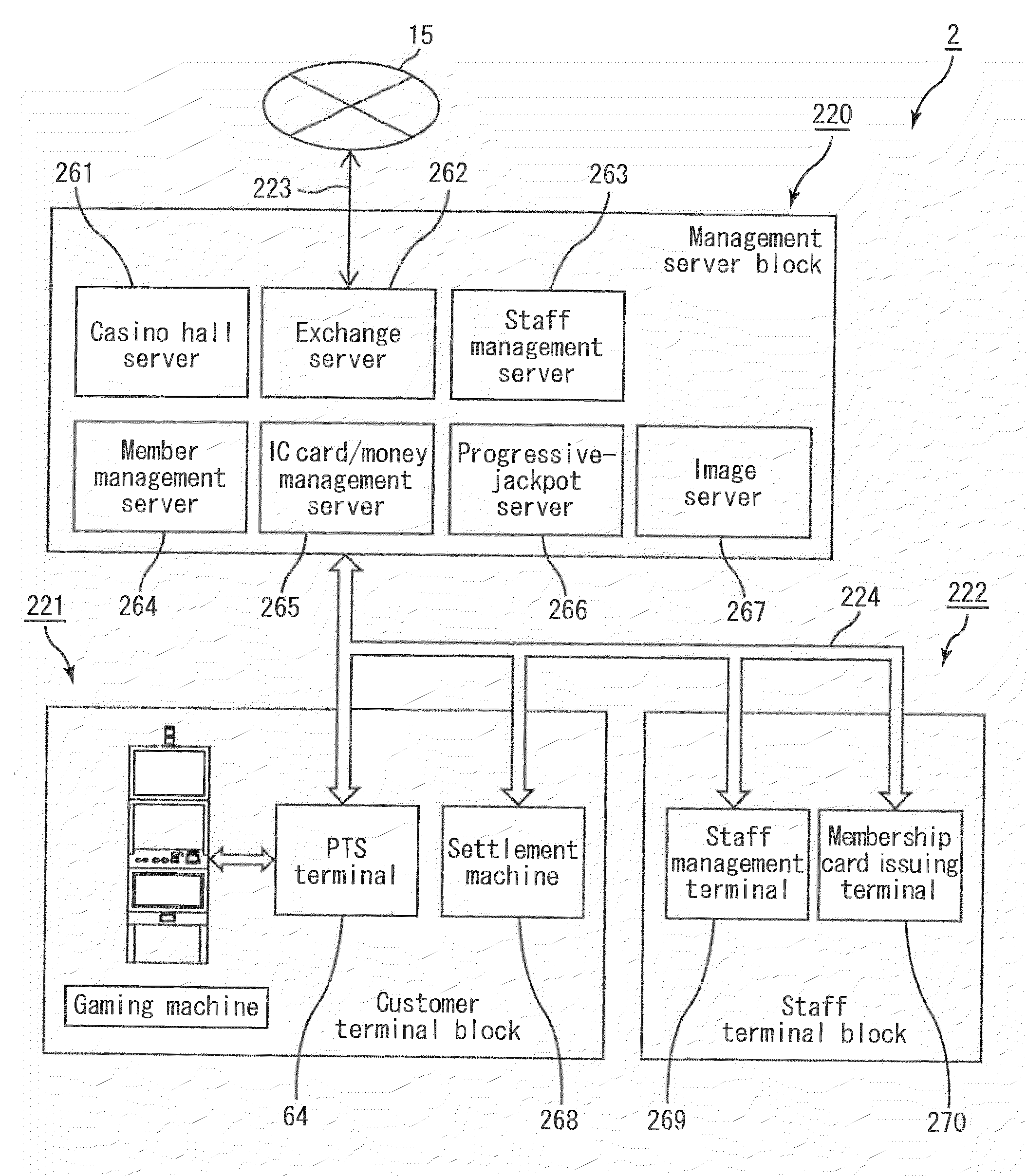

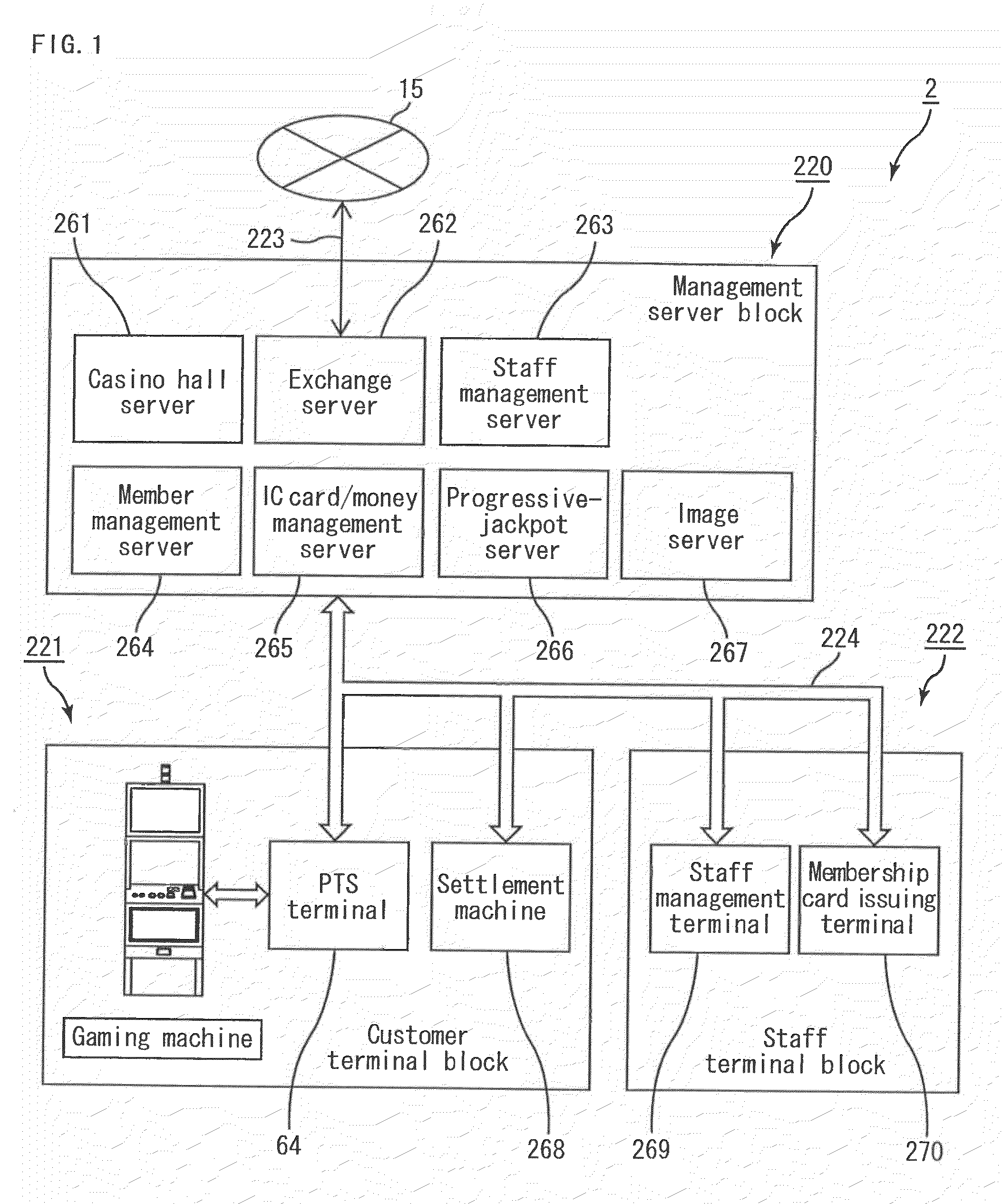

Currency value changing apparatus enabling player to play game using various currencies, gaming system where player can play game using various currencies, individual tracking apparatus, and individual tracking system

ActiveUS20100056260A1Reducing convenienceReduce the possibilityApparatus for meter-controlled dispensingCurrency conversionEngineeringGame play

The currency-value converter according to the present invention transmits amount-of-converted-currency data indicating the amount of basic currency identified based on the type of this currency, the amount of the currency and the exchange rate, to a controller installed in a gaming machine, when the type of currency accepted through a currency validator is not the basic currency. The exchange rate is a rate in which a correspondence relationship between an amount of the basic currency and an amount of another type of currency other than the basic currency is set for each type of currency other than the basic currency. Then, a game is played at the gaming machine based on the transmitted amount-of-converted currency.

Owner:UNIVERSAL ENTERTAINMENT CORP

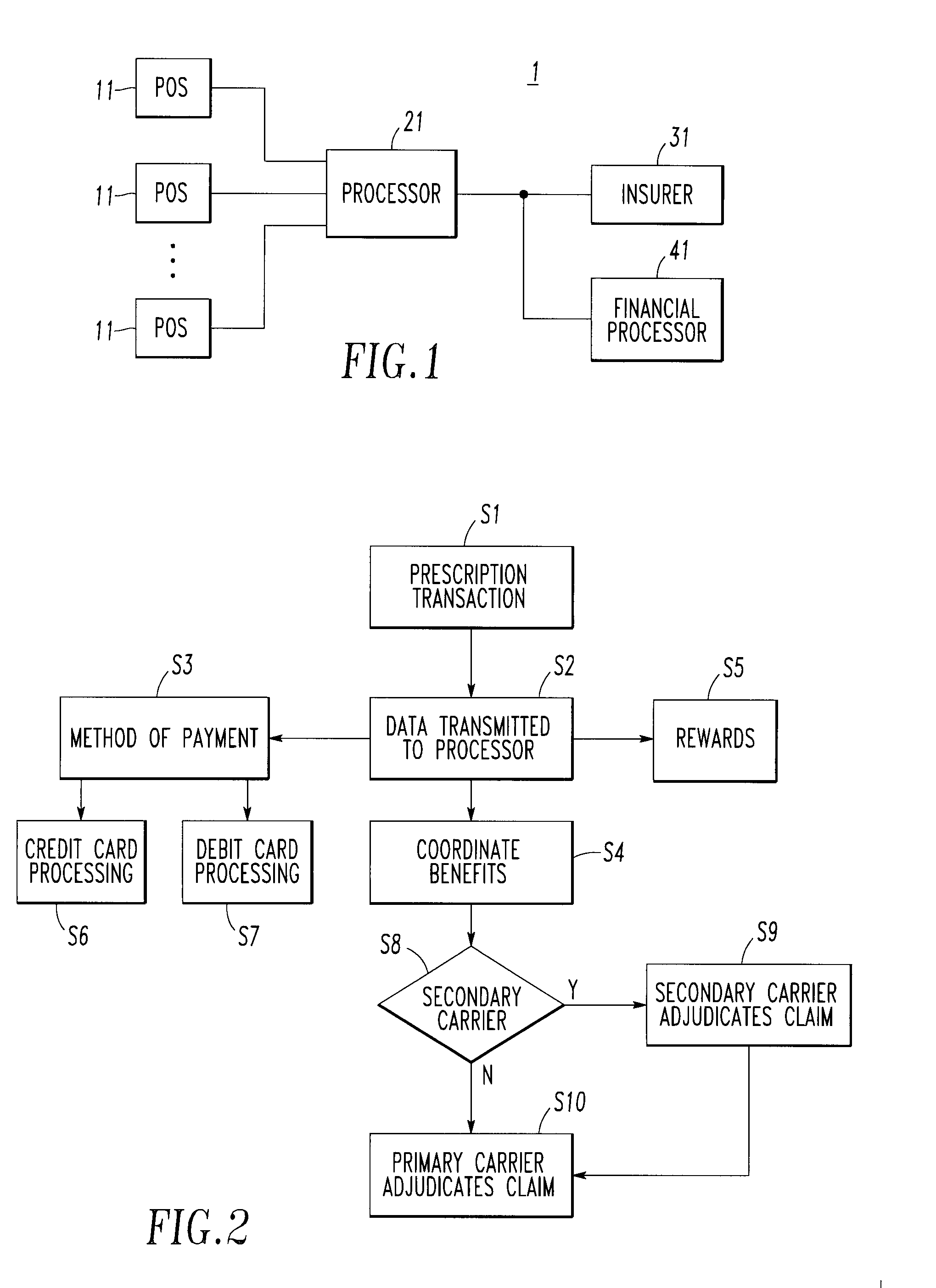

Integrated pharmaceutical accounts management system and method

InactiveUS20020002495A1Facilitate real-time adjudicationEasy to processHand manipulated computer devicesDrug and medicationsData warehouseDrug interaction

<heading lvl="0">Abstract of Disclosure< / heading> An integrated suite of services for consumers, service providers and manufacturers in the pharmaceutical industry is disclosed. The present invention utilizes one or more of the NCPDP standard formats and adopts the switch for an integrated system of, for example, instant adjudication of prescriptions, consumer data warehousing and / or incentive rewards for the consumer. A participating consumer with one card, can instantly purchase pharmaceuticals and charge the transaction to a credit card and earn and apply savings dollars redeemable for pharmaceutical purchases. For a participating service provider, instant adjudication and instant validation of consumer eligibility can be performed. Moreover, a service provider may receive messages related to the patient's medications. Significantly, data is recorded for consumers even when consumers make the pharmaceutical purchase with cash. The system includes a unique card issued to participating consumers. The card is adapted to encode conventional credit or debit card information specific to the participating consumer so that the consumer can consummate a transaction for the purchase of pharmaceuticals without possession of an additional credit card. The system further includes a host processor coupled to the point of sale at the service provider through a leased line or public switch network or the like. When a customer performs a pharmaceutical transaction at the point of sale of the service provider, the host processor coordinates any benefits and data with other prescription benefit management systems through messages transmitted and received from any primary or secondary carrier systems. The host processor further is adapted to facilitate real-time adjudication of claims and checks for any dangerous drug-to-drug interactions. The host processor additionally facilitates any financial processing including the accumulation and redemption of any bonus dollars earned by the consumer. Furthermore, since the card used by the consumer can be encoded with credit or debit card information, the host processor determines the desired payment method and performs the actual financial transaction. Even if the transaction at the point of sale is a cash purchase, the consumer may desire to use his unique card for the accrual of bonus dollars. Therefore, data concerning the transaction (i.e., pharmacy number, prescription number, etc.) can be recorded even for transactions conducted with cash.

Owner:NPAX

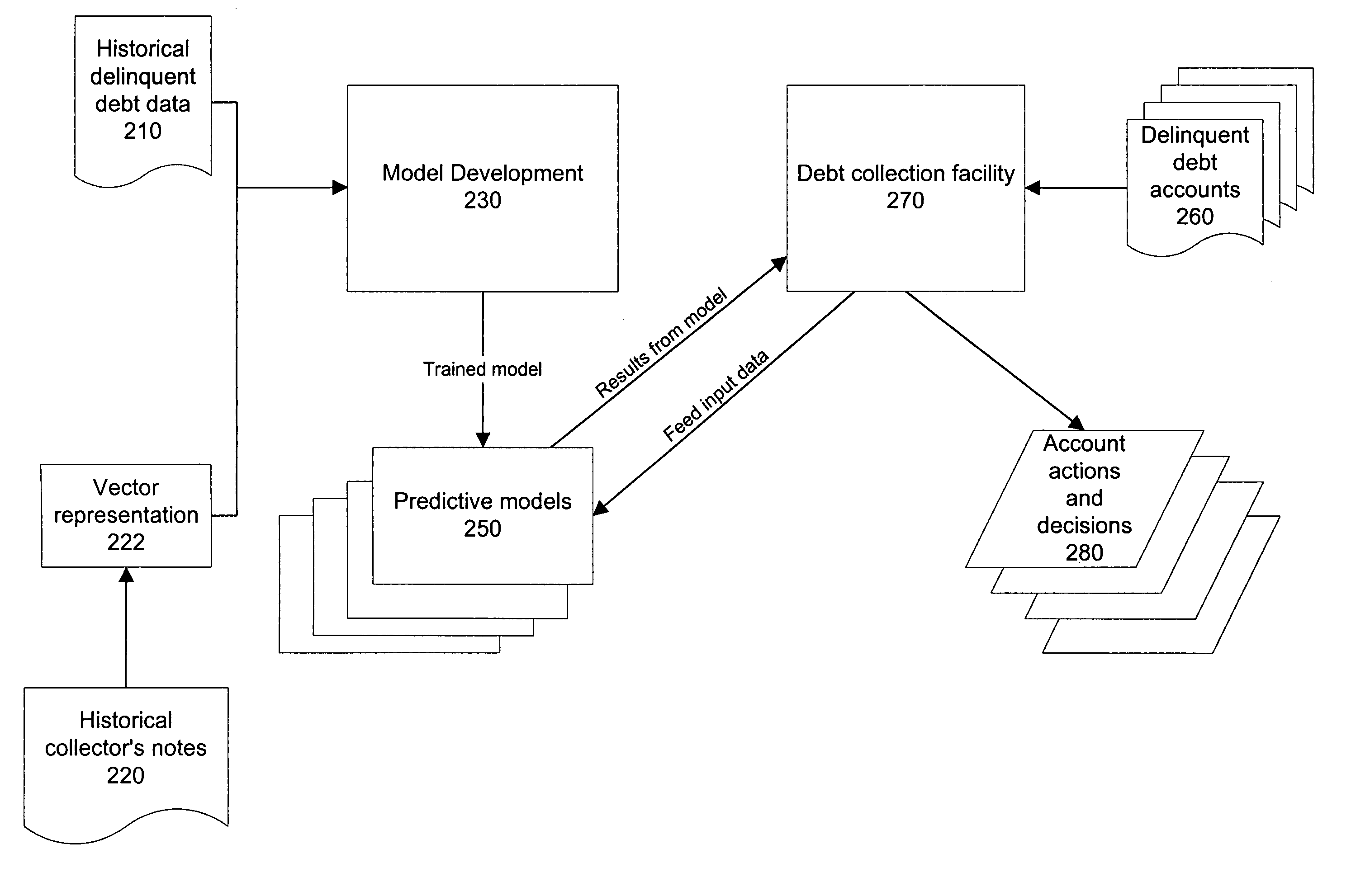

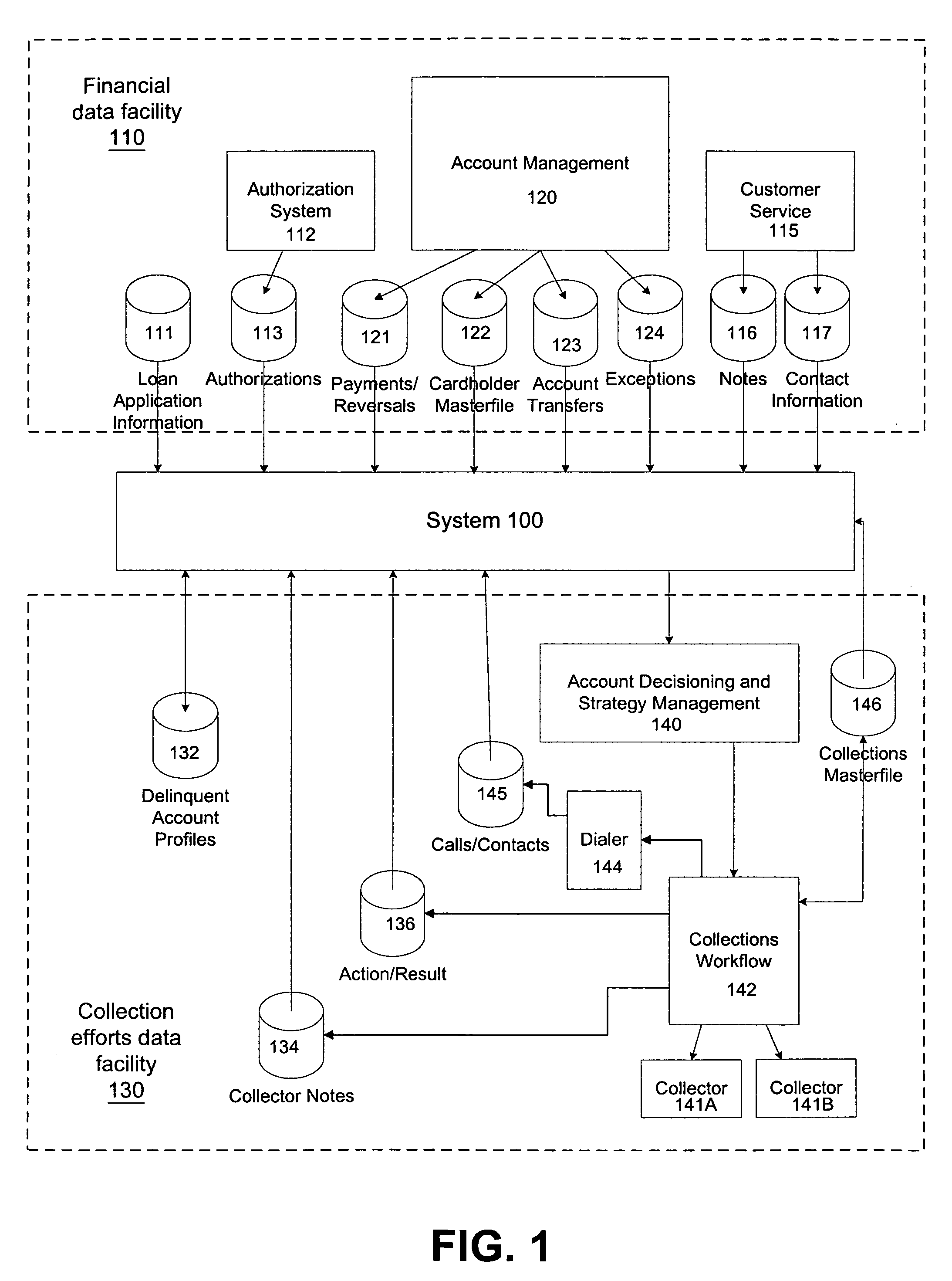

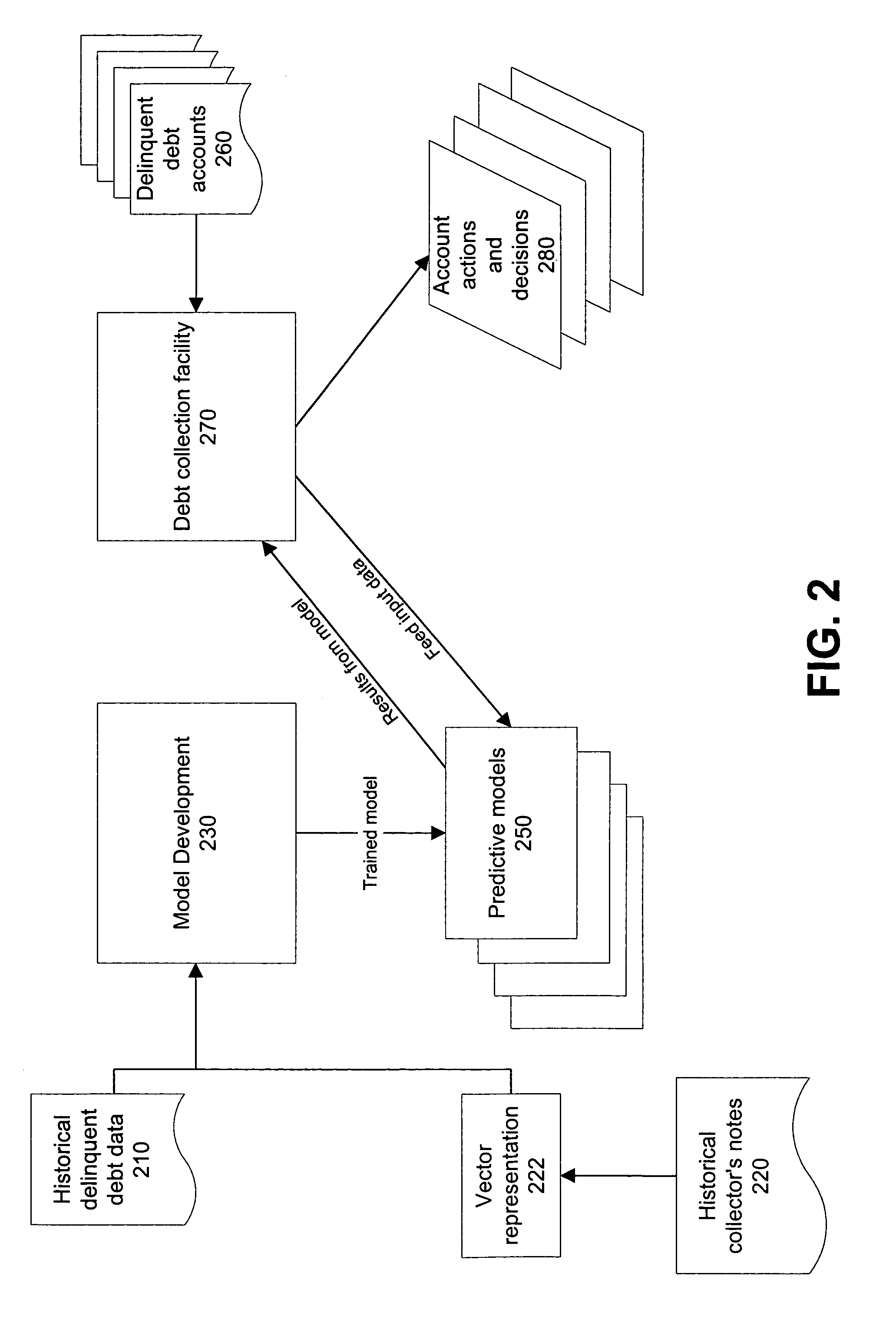

Enhancing delinquent debt collection using statistical models of debt historical information and account events

A predictive model, for example, a neural network, evaluates individual debt holder accounts and predicts the amount that will be collected on each account based on learned relationships among known variables. The predictive model is generated using historical data of delinquent debt accounts, the collection methods used to collect the debts in the accounts, and the success of the collection methods. In one embodiment, the predictive model is generated using profiles of delinquent debt accounts summarizing patterns of events in the accounts, and the success of the collection effort in each account. In another embodiment, the predictive model includes a mathematical representation of the collector's notes created during the collection period for each account.

Owner:FAIR ISAAC & CO INC

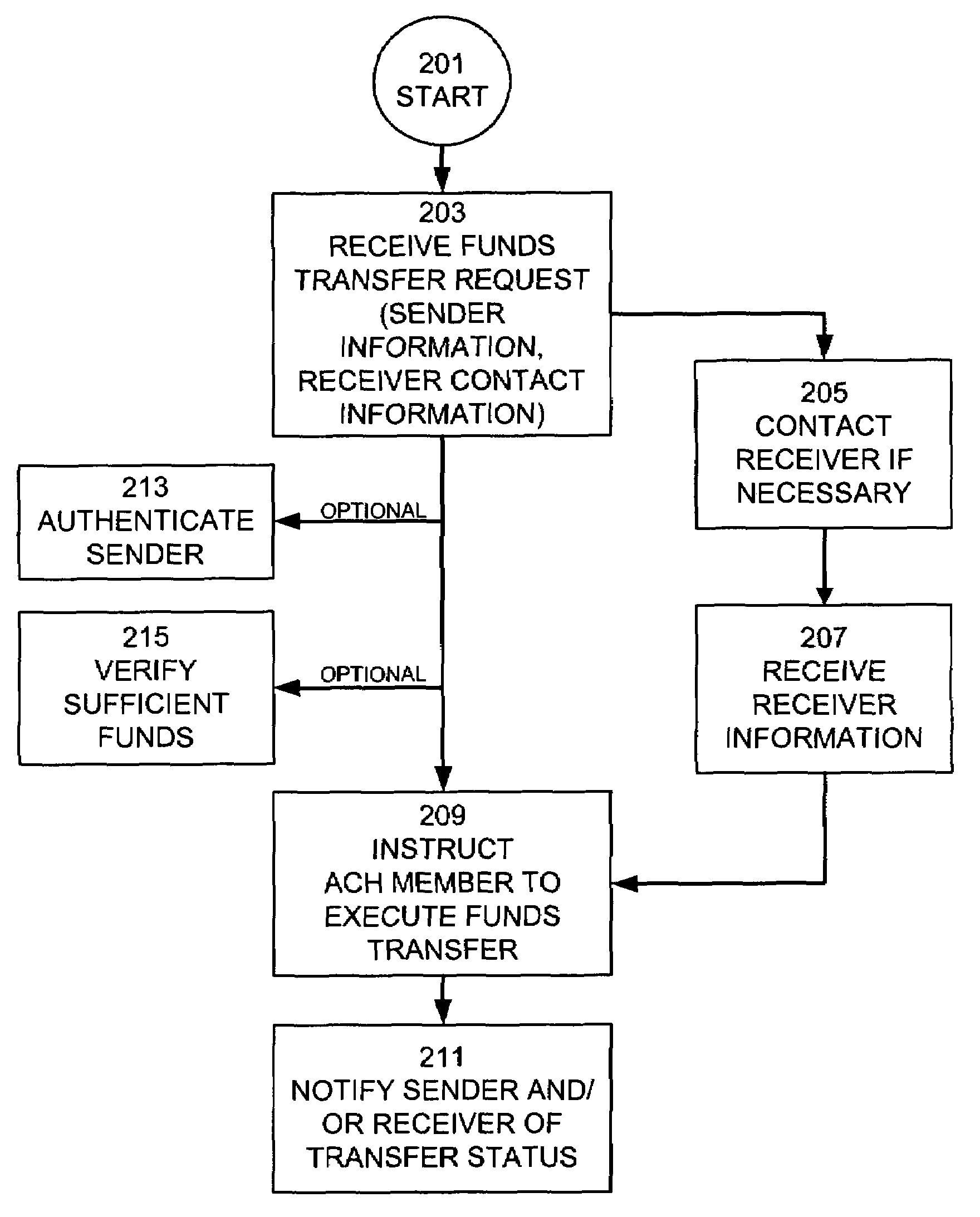

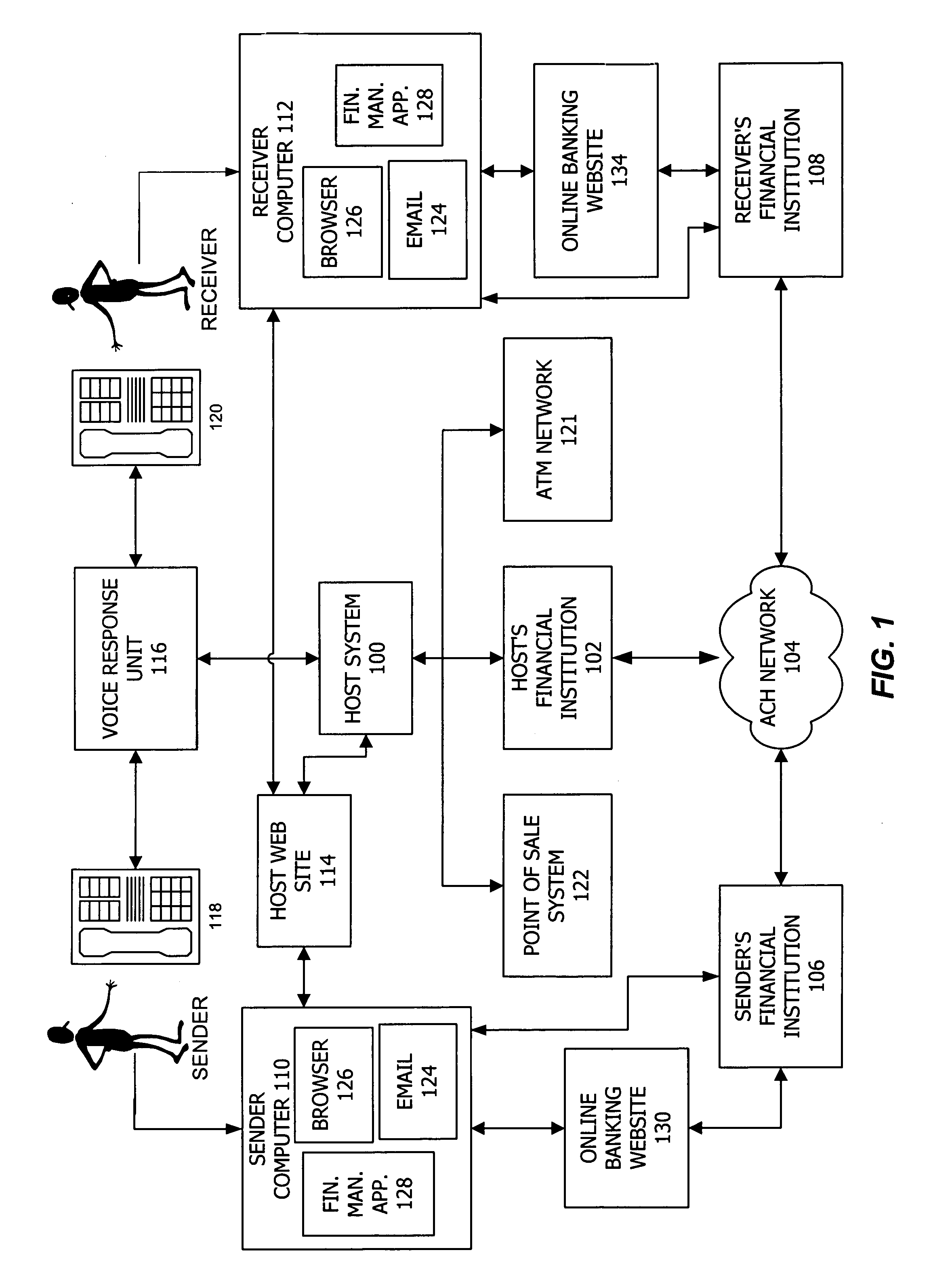

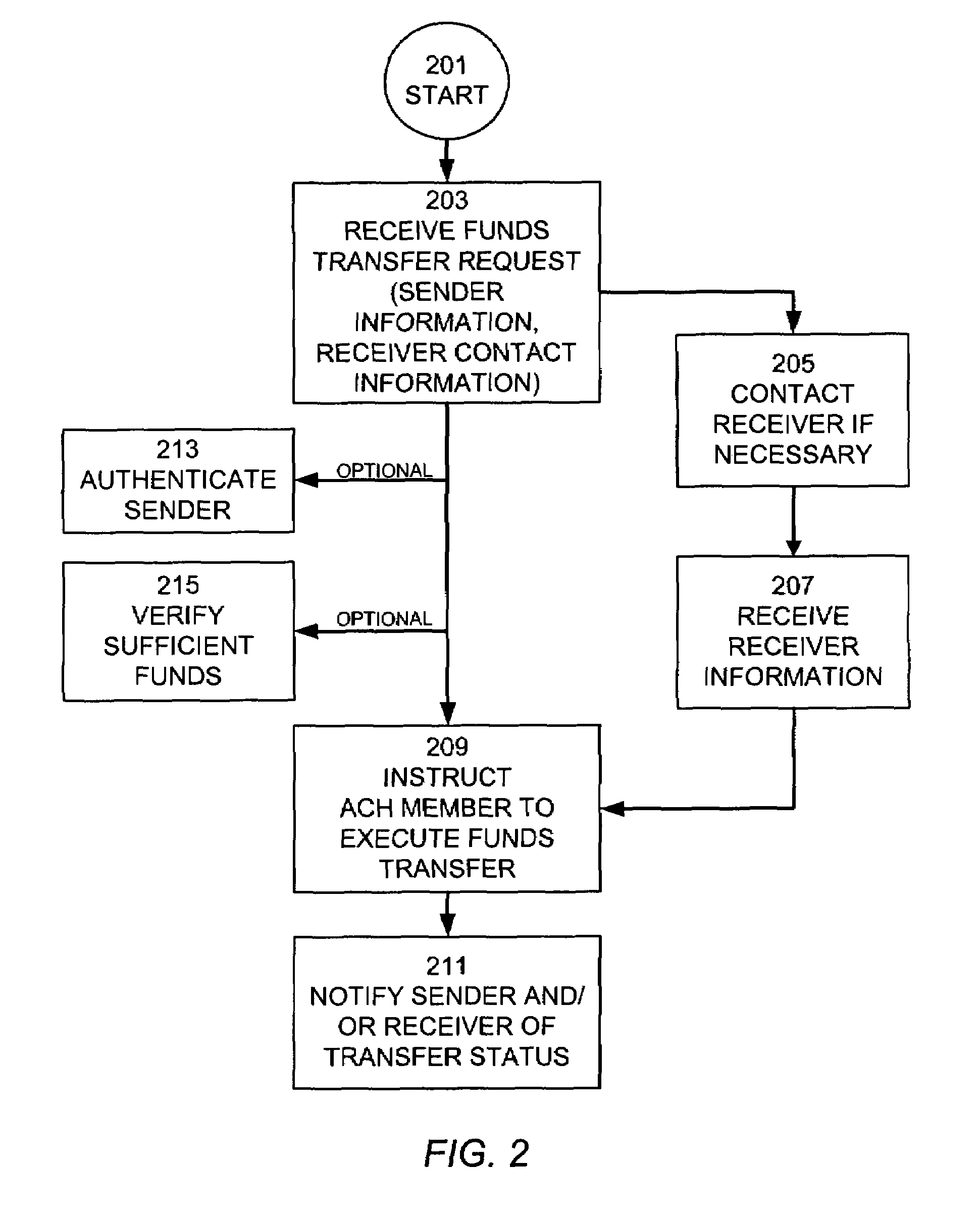

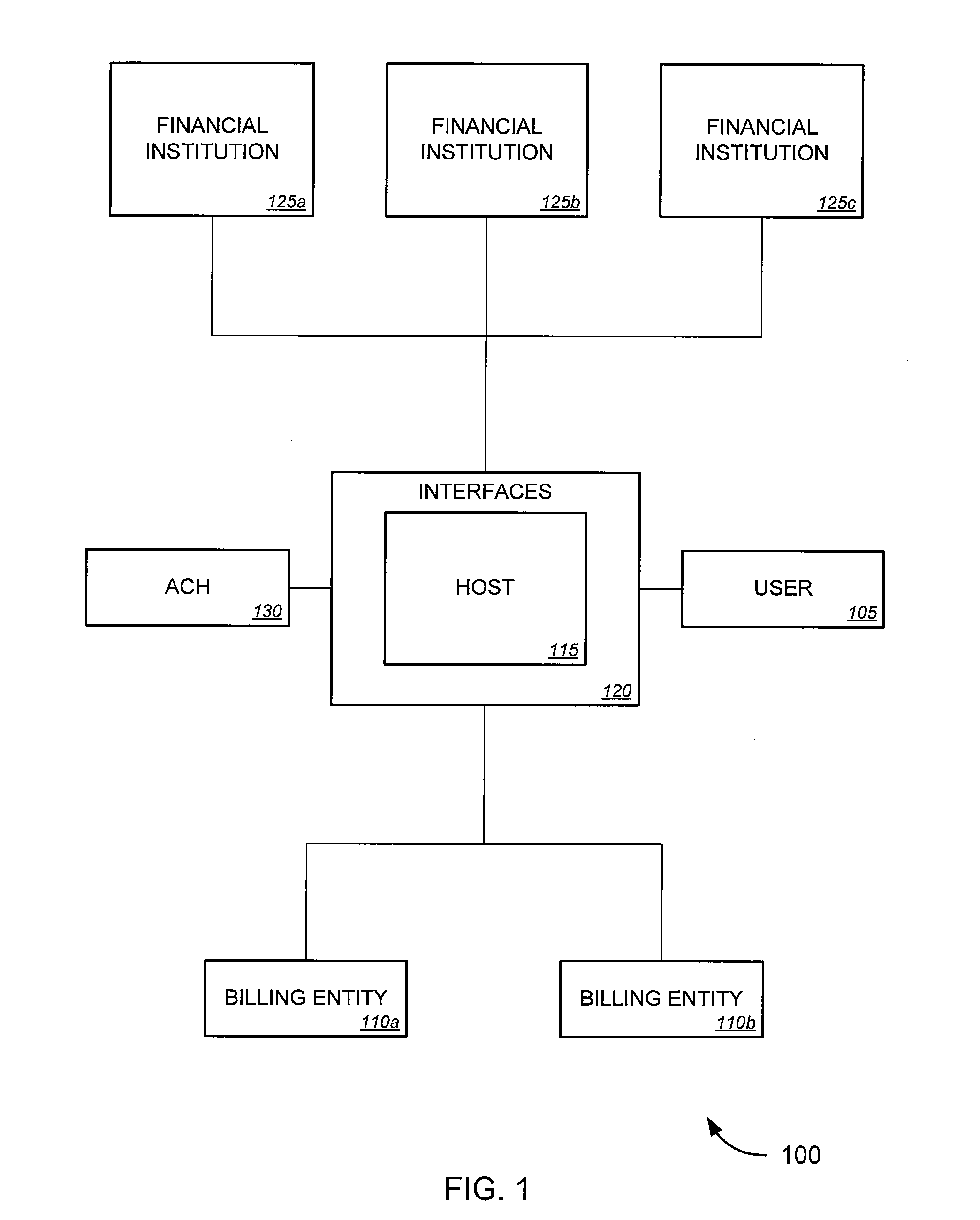

Consumer-directed financial transfers using automated clearinghouse networks

InactiveUS7395241B1Allocation is accurateEliminate contactComplete banking machinesFinanceThe InternetCheque

Consumer directed transfers of funds over the Internet are provided by a combination of systems and networks, including the Internet, email, and the Automated Clearinghouse system (ACH). A host system provided by a funds transfer service manages requests of senders to transfer funds and further manages responses of receivers to claim funds. The host system allows the sender to initiate the funds transfer by specifying the amount of the transfer and information for contacting the receiver, without the need to specify the account of the receiver for receiving the funds. Instead, the host system contacts the receiver and informs the receiver of the available funds; the receiver can then provide the necessary target account information for completing the funds transfer. The ACH is used to effect the transfer of funds, with the host system providing instructions for ACH entries to its financial institution using account information separately received from the sender and receiver. The credit risk associated with originating ACH entries is reduced by use of the Point of Sale system to verify sufficient funds in the sender's account by comparing the closing balance of the day the funds transfer is requested with the transfer amount. Sender fraud is reduced by comparing a sender provided balance (or check number / amounts) with an account balance acquired through automated means such as the POS system or ATM network.

Owner:INTUIT INC

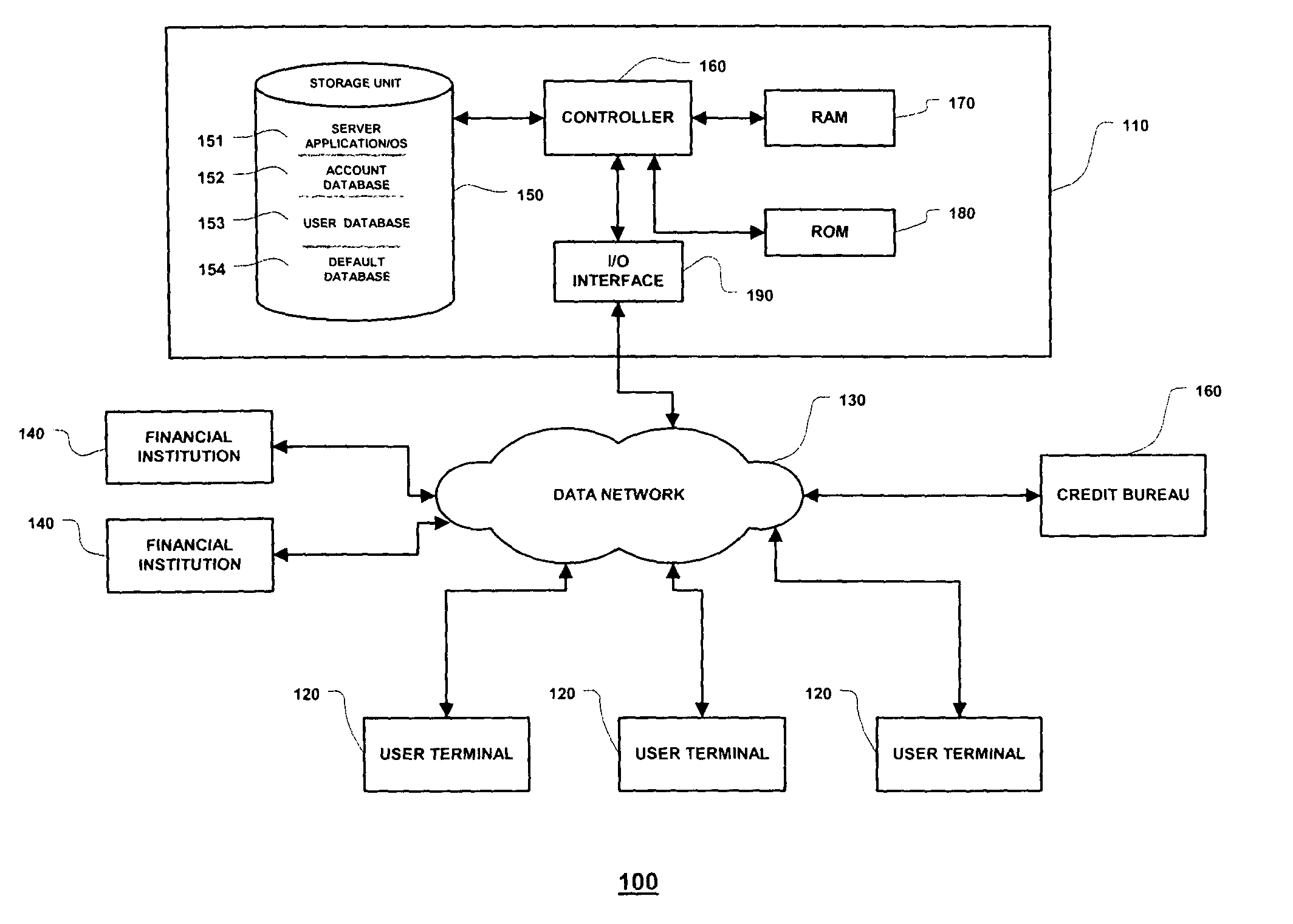

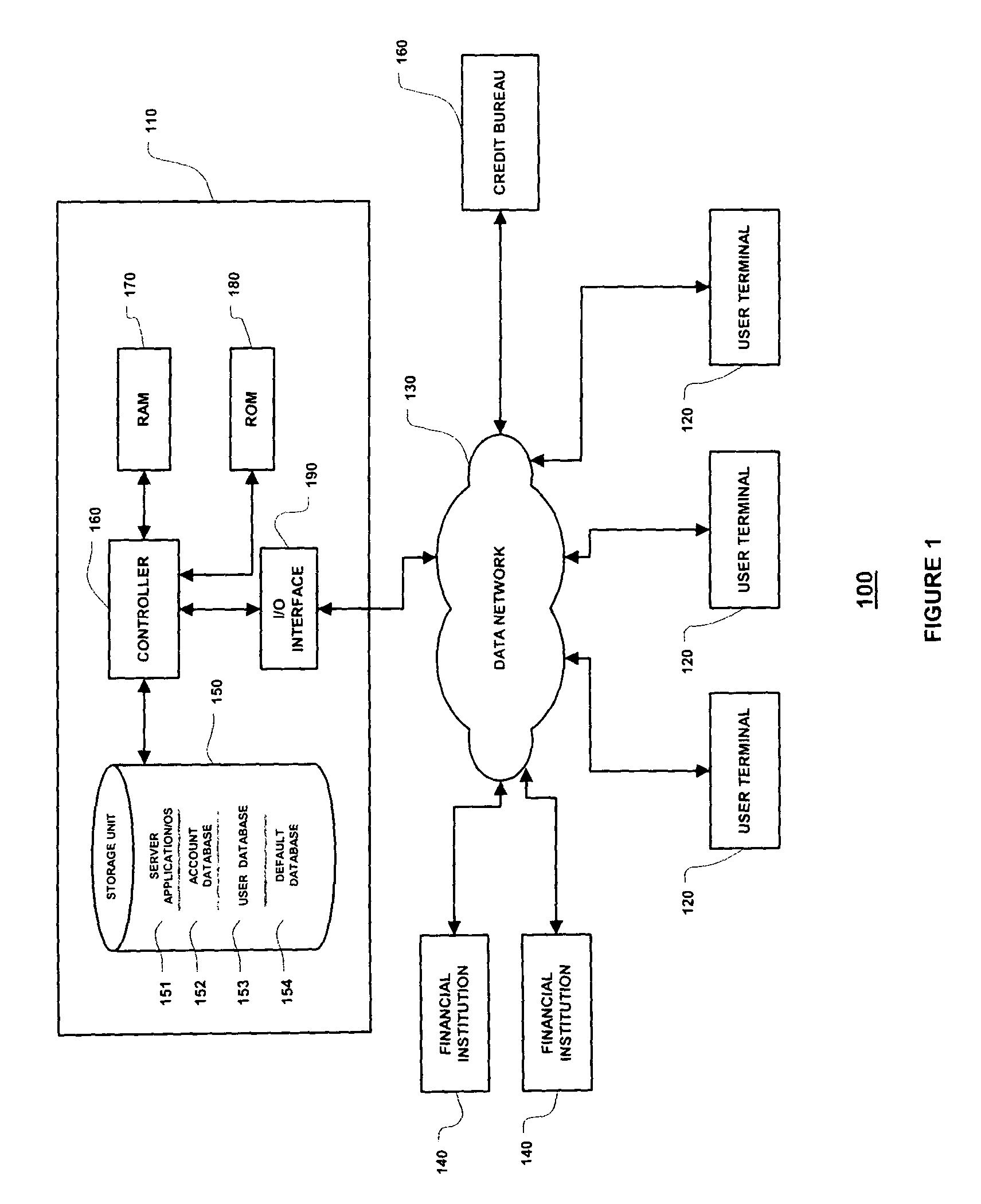

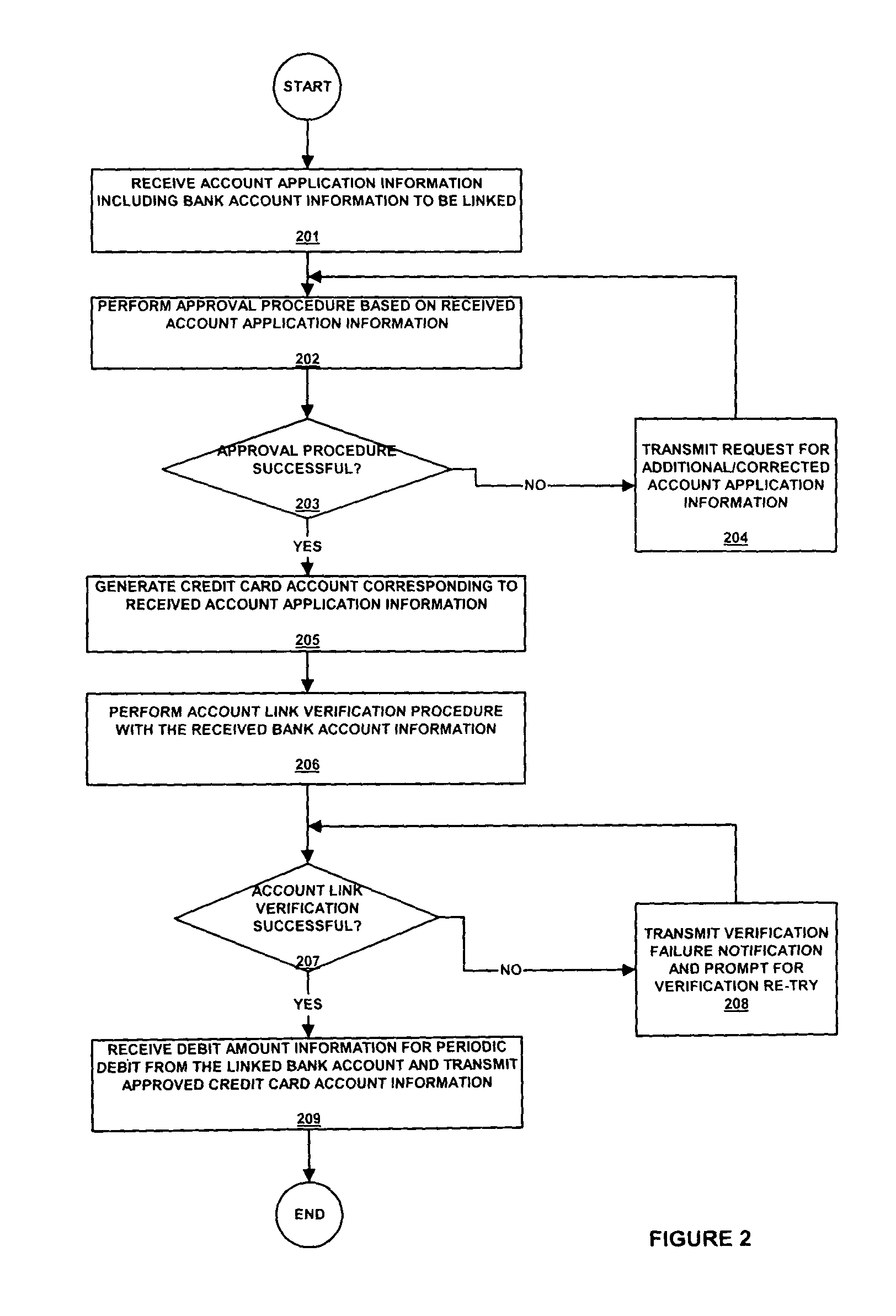

Method and system for underwriting and servicing financial accounts

Method and system for providing financial account underwriting and servicing exclusively using online transactions by requiring a link to the account holder's bank account as a condition of account approval process and account servicing performed exclusively online with the account holders including the steps of receiving account application information including a bank account information, depositing at least one deposit amount to the bank account corresponding to the received bank account information, receiving a deposit verification amount, from the applicant, confirming the deposit verification amount received from the applicant, and generating a financial account corresponding to the received account application information, where the financial account is electronically linked to the bank account for periodic debit transaction to withdraw funds from the linked bank account and to deposit the withdrawn funds into the linked financial account, and a server terminal configured to perform these steps are provided.

Owner:HATTERSLEY MICHAEL +2

Method, transaction card or identification system for transaction network comprising proprietary card network, eft, ach, or atm, and global account for end user automatic or manual presetting or adjustment of multiple account balance payoff, billing cycles, budget control and overdraft or fraud protection for at least one transaction debit using at least two related financial accounts to maximize both end user control and global account issuer fees from end users and merchants, including account, transaction and interchange fees

InactiveUS20070168265A1Increase flexibilityEasy maintenanceComplete banking machinesFinanceCredit cardFinancial transaction

The present invention provides methods, systems and transaction cards or identification systems, using transaction network comprising proprietary card network, EFT, ACH, or ATM, for end user management of a global financial account by manual or automatic prepaying, prepaying, paying or unpaying, debiting or crediting, or readjustment or presetting, using parameters relating to portions of paid or unpaid financial transactions or account balance amounts in multiple credit, cash or other existing, or end user created, financial accounts or sub-accounts in said global financial account that is optionally subject to financial account issuer transaction or readjustment fees from end users and merchants, including optional use for financial transactions as a credit transaction card requiring merchant credit card interchange or other fees, and optional end user fees, as additional revenue to the global account issuer.

Owner:ROSENBERGER RONALD JOHN

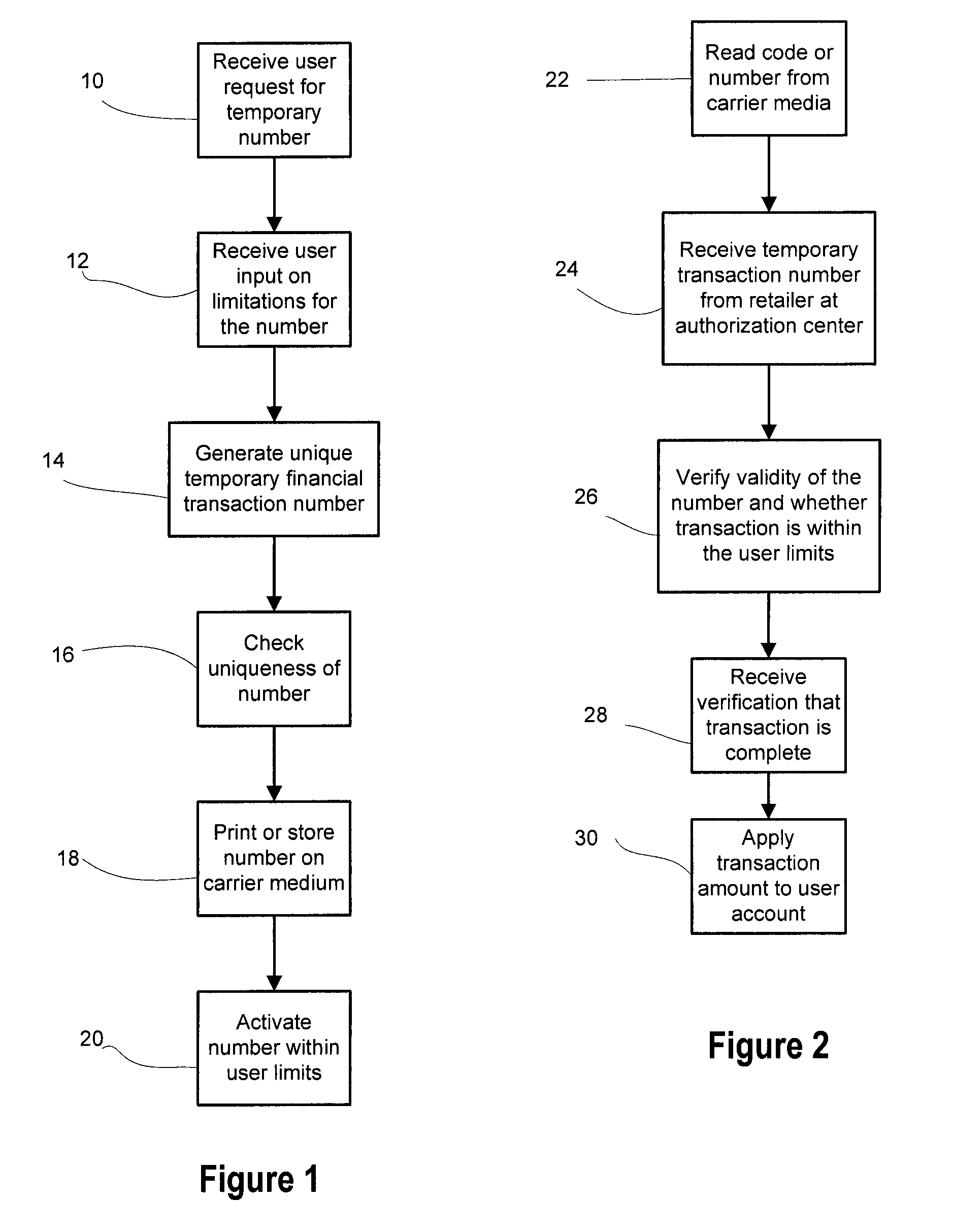

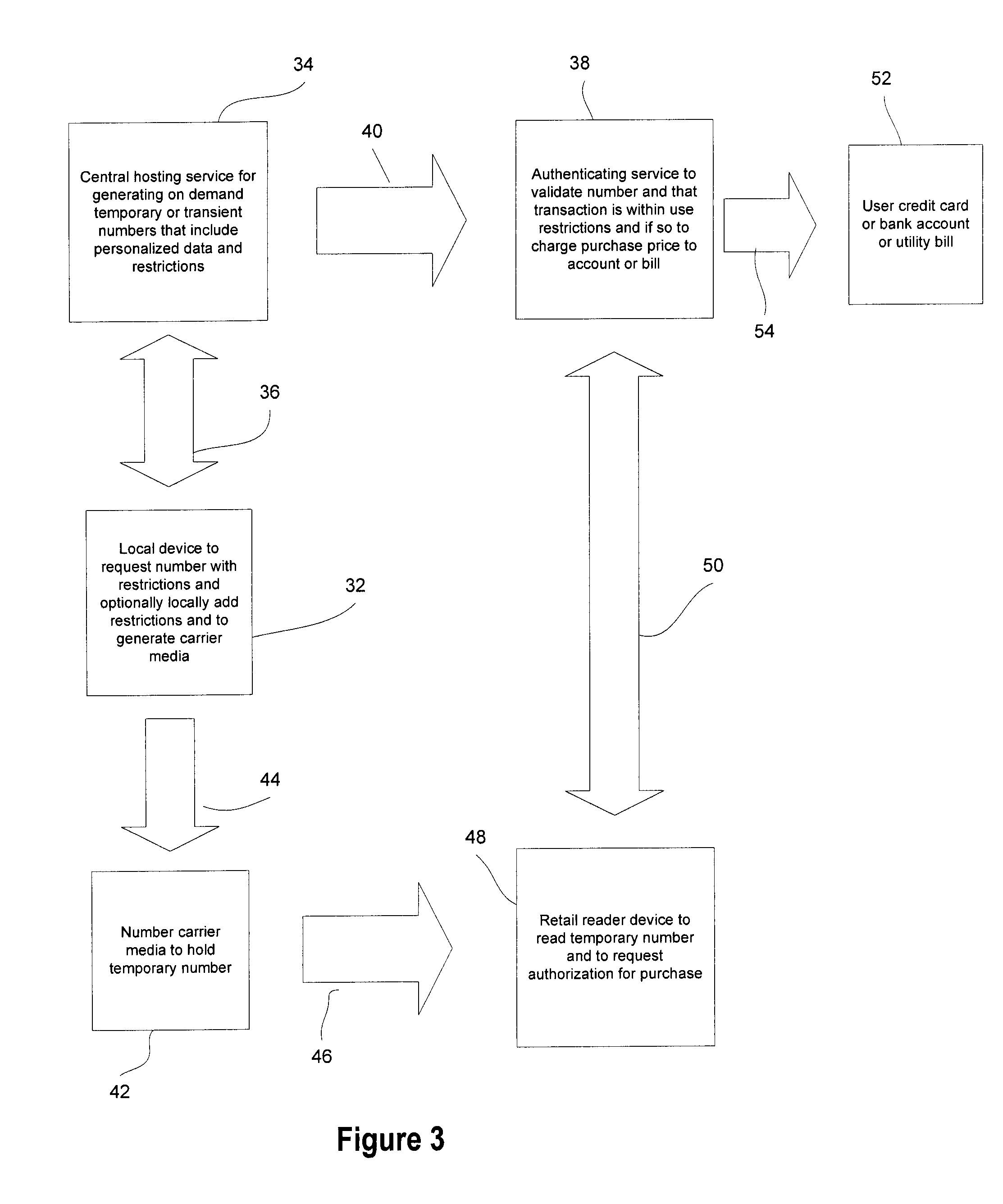

Method and apparatus for use of a temporary financial transaction number or code

A temporary financial transaction number is generated for conducting a financial transaction, such as for paying for goods or services. The temporary number has limits on use, such as time, and amount limits and limits on the type of goods or services that may be purchased or on the type of business at which the purchase may be made. The limits may be encoded into the temporary number or otherwise linked to the number. User identification information, or information on other authorized users, may also be encoded into the number or otherwise linked to the number. When presented for a payment, the number is checked for validity as well as whether the purchase is within the limits. An authorized purchase is applied against a user bank account or credit card account without disclosure of the account information. The temporary number is printed or is displayed on a display of a portable electronic device for presentation to the seller, or is transmitted to the seller for on-line purchases.

Owner:IPDEV

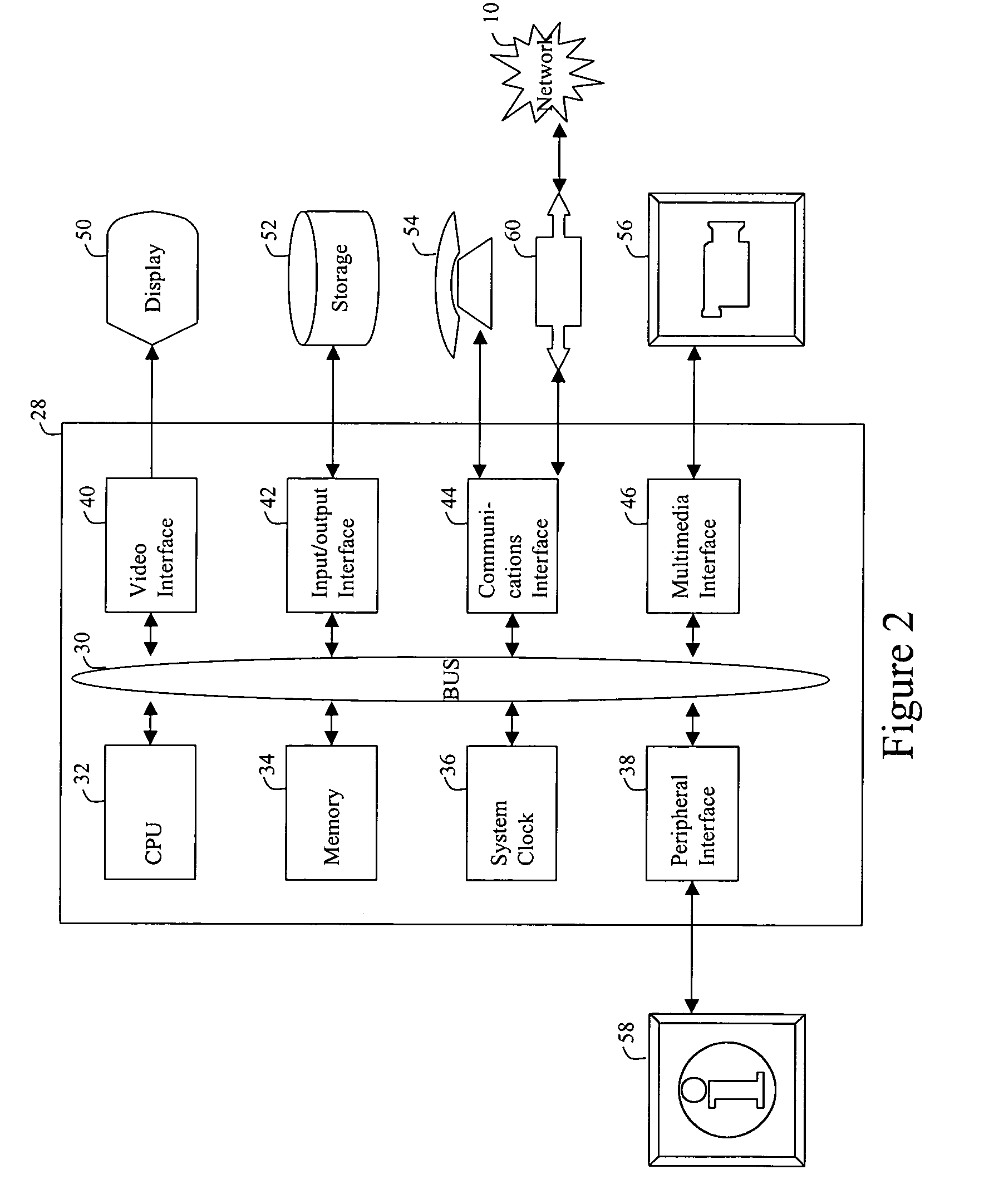

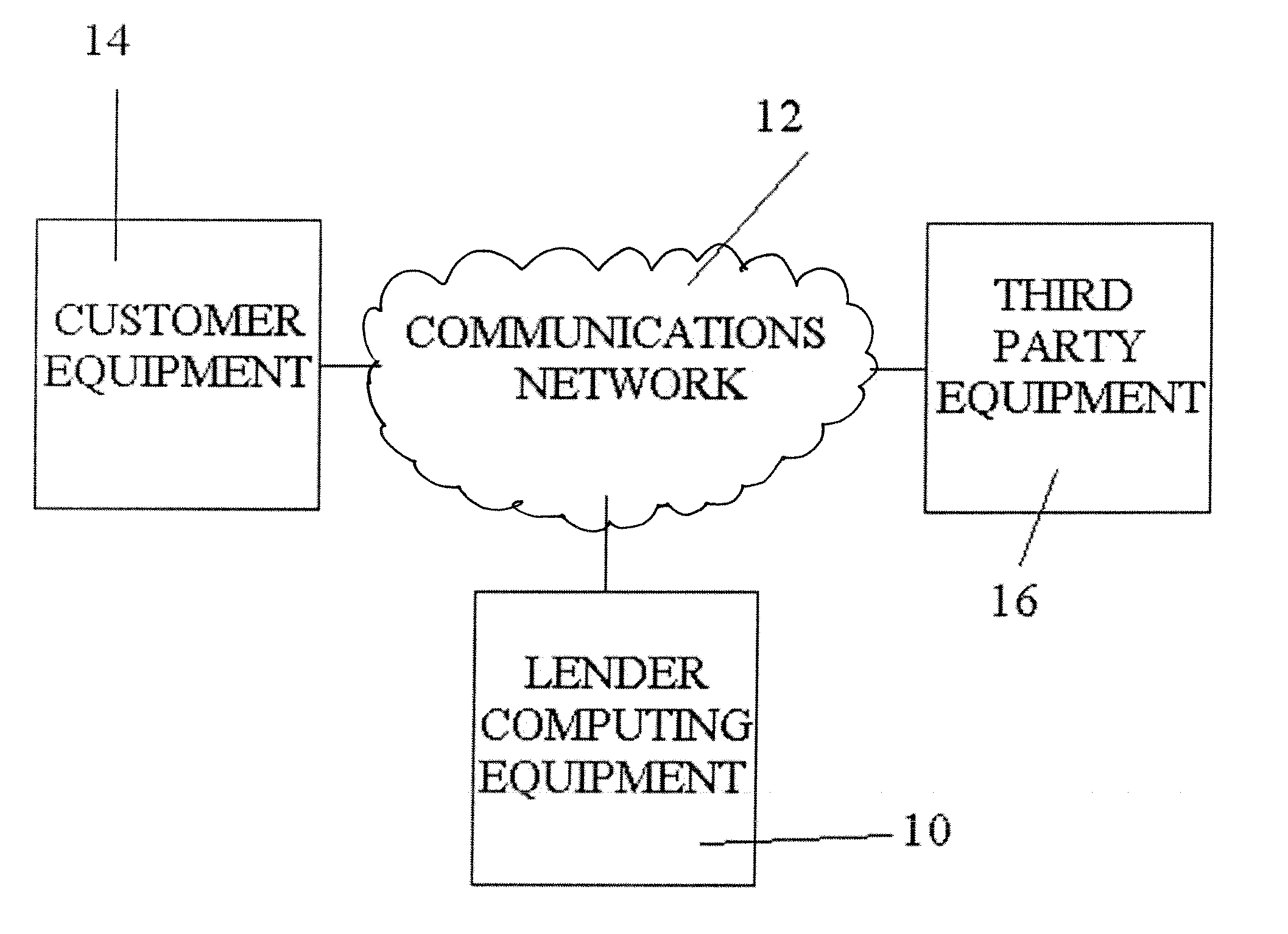

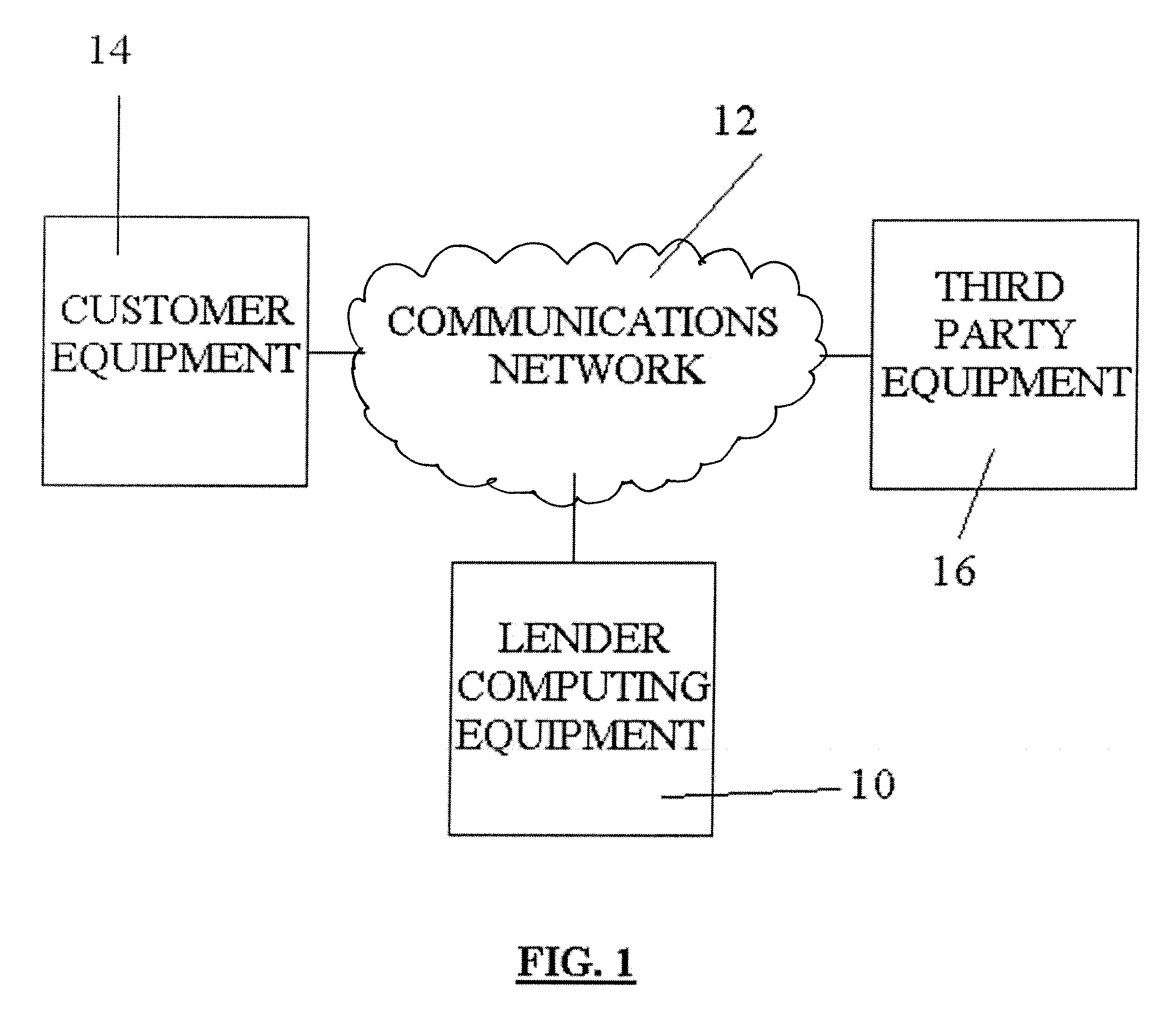

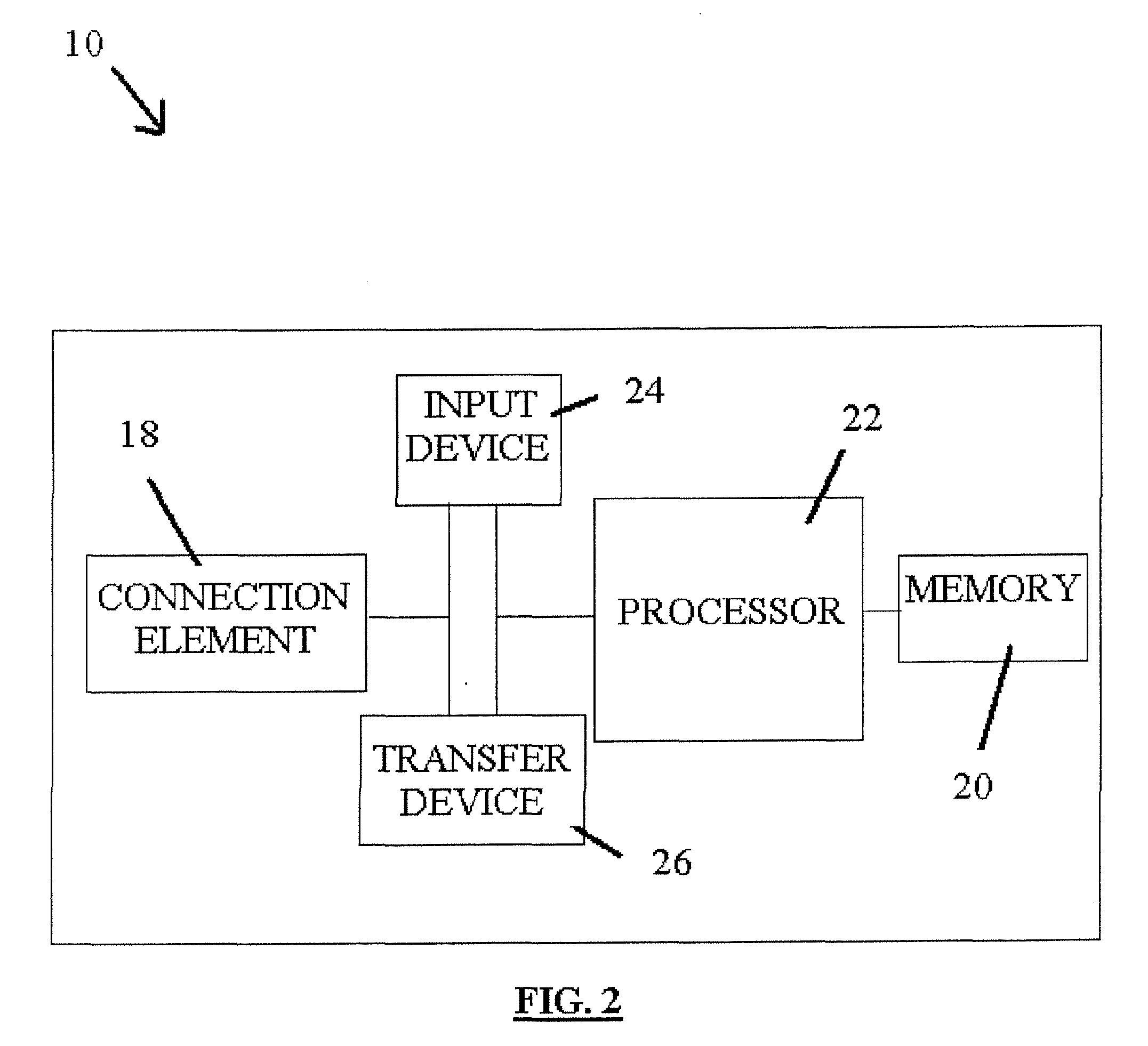

Method, system, and computer program for on-demand short term loan processing and overdraft protection

A method, system, and computer program for on-demand short term loan processing and overdraft protection is disclosed which utilizes computing equipment (10) to expedite and facilitate loan approval, overdraft protection, and the transfer of funds. The method generally includes the steps of: establishing a customer account for a customer; receiving a request for overdraft protection from the customer; utilizing computing equipment to approve the request for overdraft protection; receiving a request for funds due to a transaction initiated by the customer; utilizing computing equipment to automatically provide an overdraft protection amount when the customer account lacks sufficient funds to cover the initiated transaction; and automatically withdrawing the overdraft protection amount and an overdraft fee from the customer account when additional funds are deposited into the customer account.

Owner:TUCKER SCOTT A

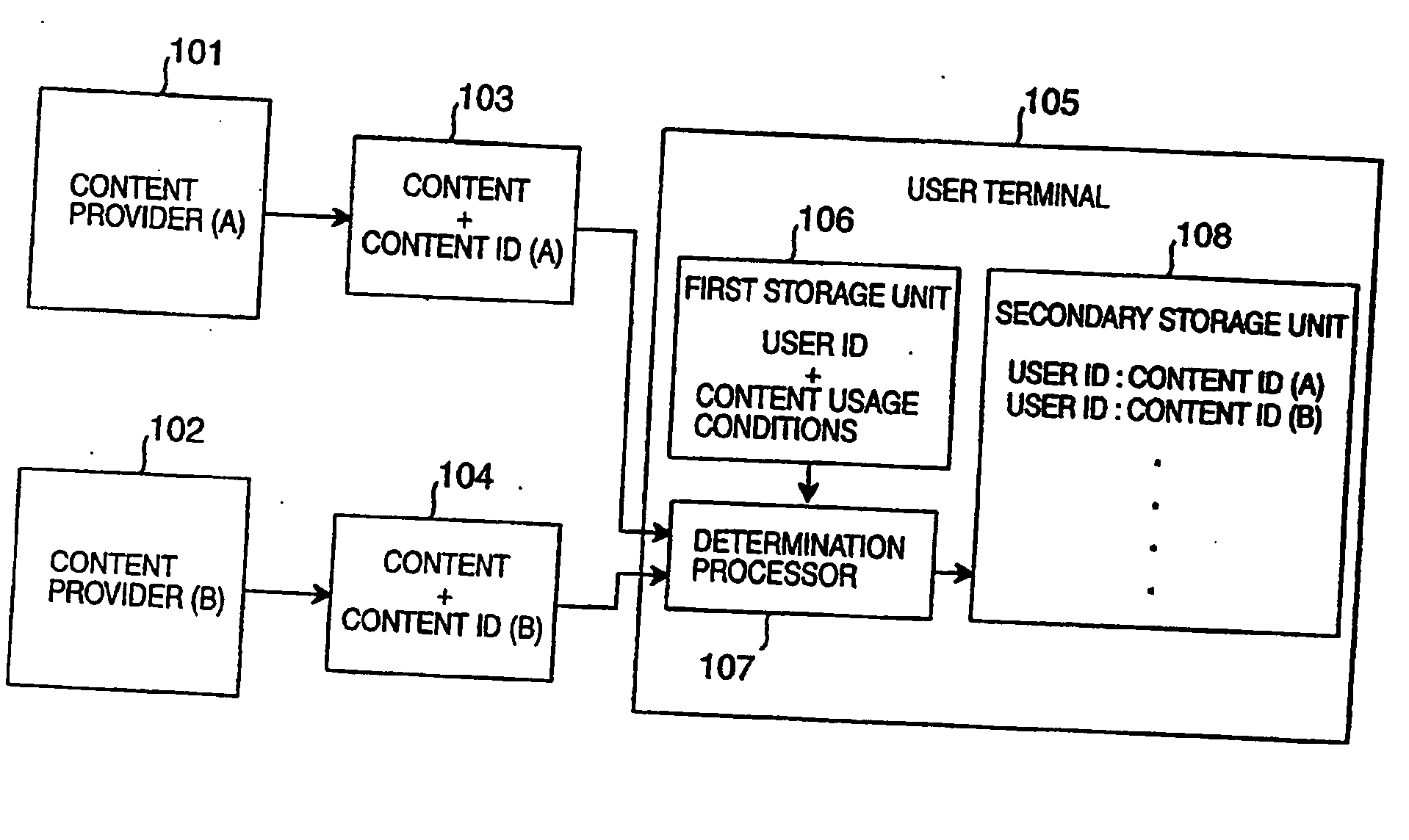

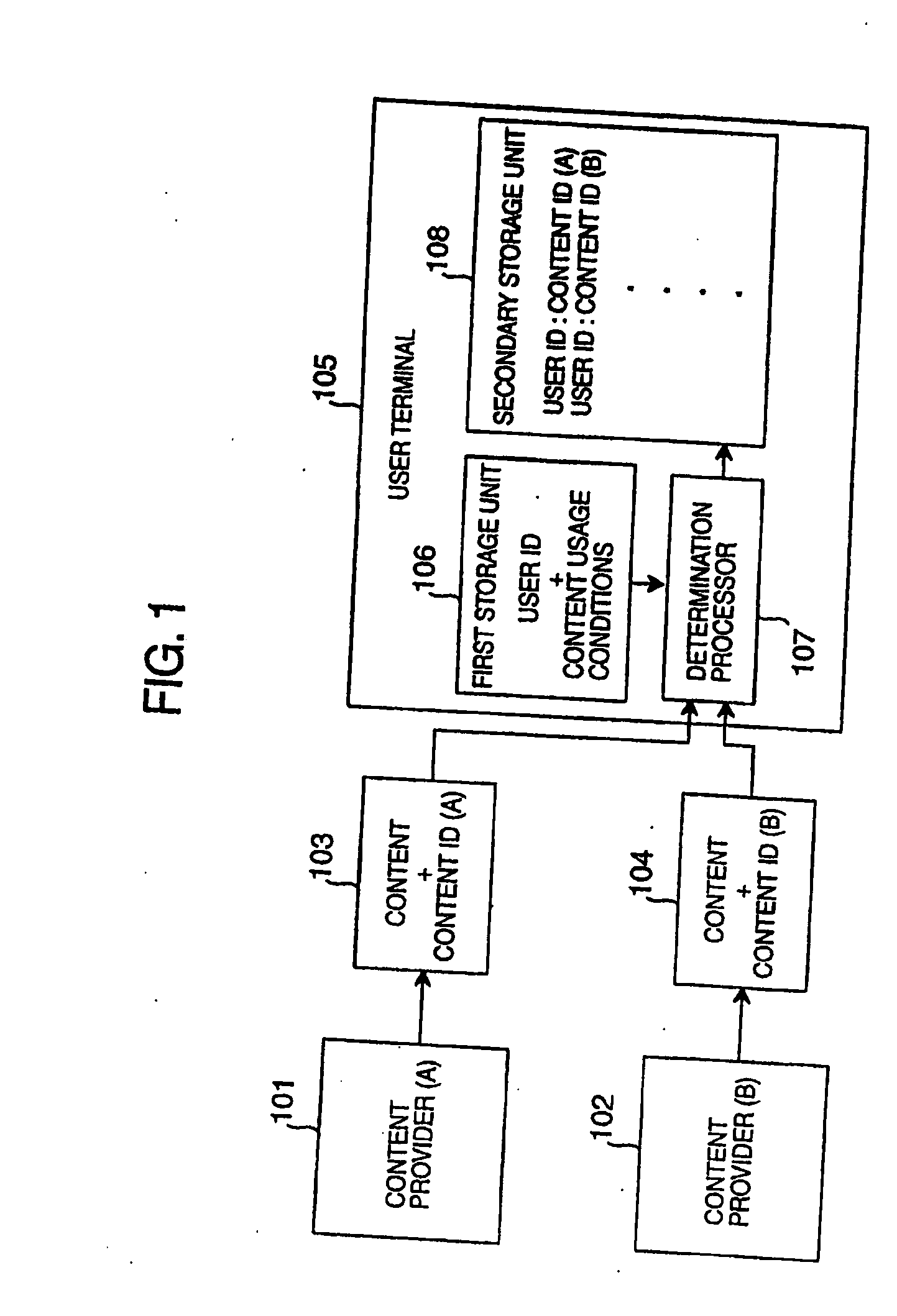

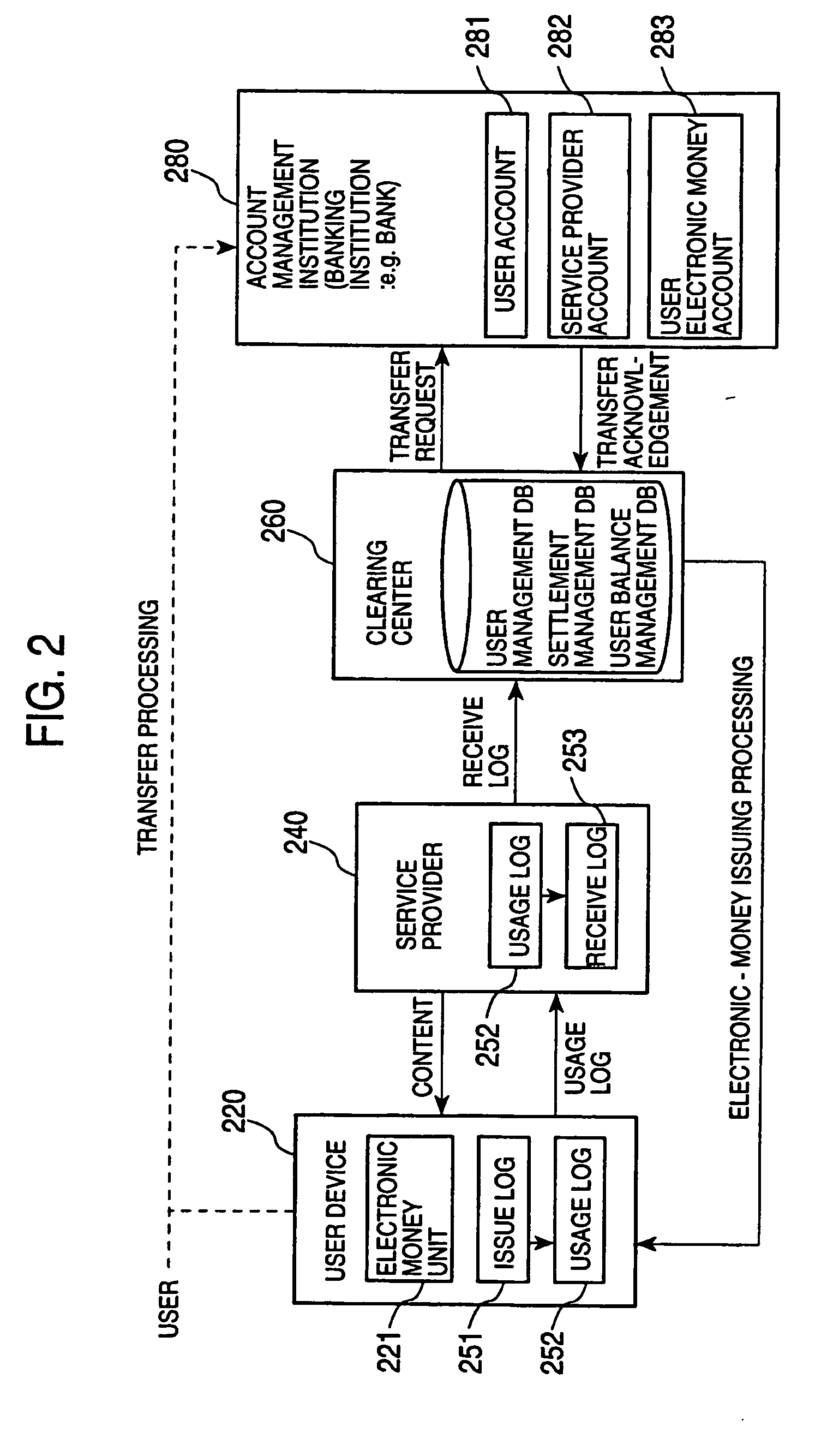

Content usage management system method, and program providing medium therefor

InactiveUS20060112016A1Transaction can be blockedAvoid distributingDiscounts/incentivesFinanceUser deviceService provision

When the encrypted content is provided from a service provider to a user device, a usage log including information of the content usage fee is created in the user device. The created usage log is then sent to the service provider. The service provider compares the content usage fee in the received usage log with a predetermined threshold. If the content usage fee is found to exceed the predetermined threshold, the service provider requests a clearing center to inquire about the electronic money balance of the user. If it is determined that it seems difficult to collect money from the user, the transmission of a content key to the user is suspended. The clearing center also creates an issue log in which the effective period and an allowable amount of money spent by the user are set, and performs settlement processing only when the payment of the content usage fee has been made within the effective period.

Owner:SONY CORP

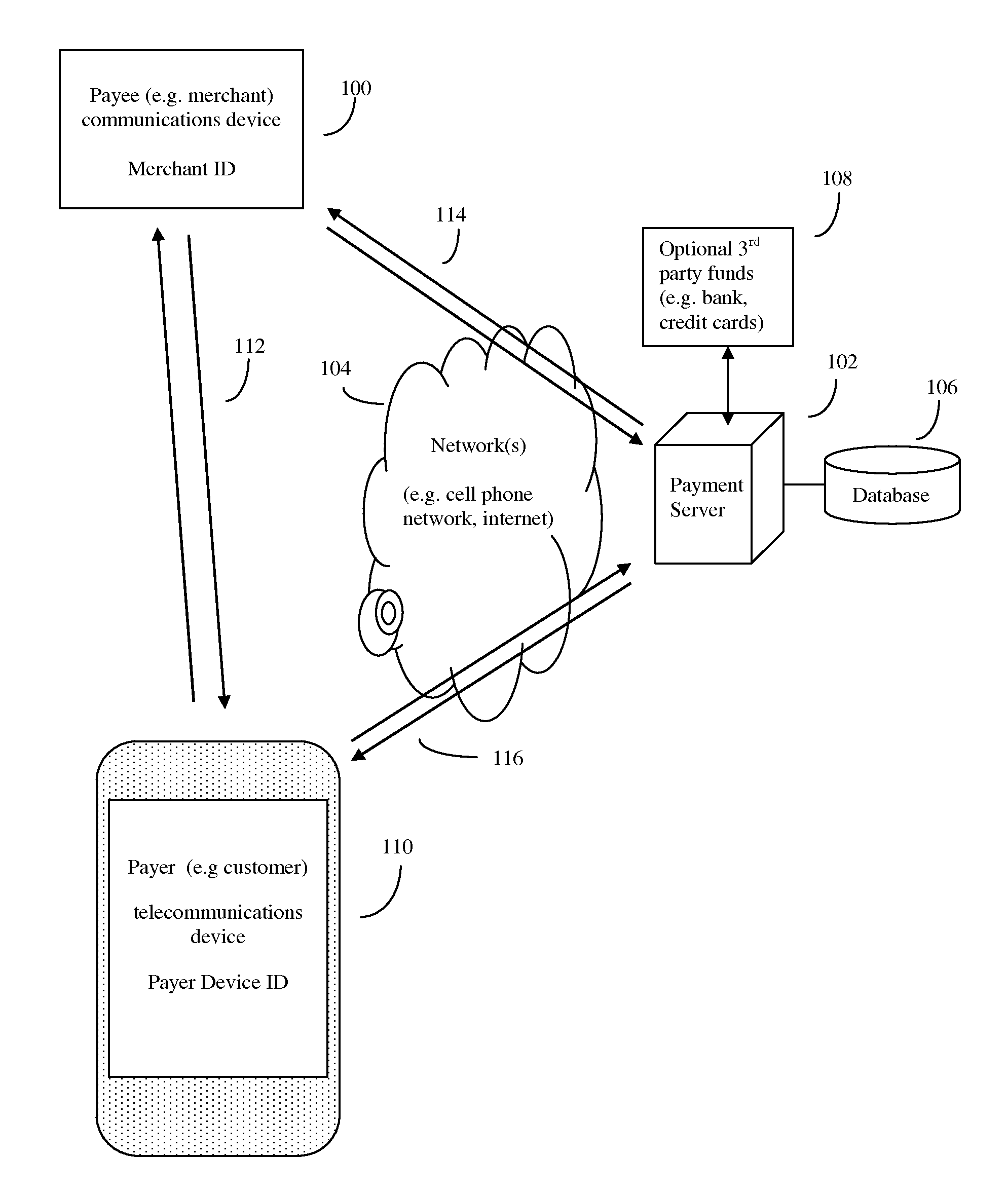

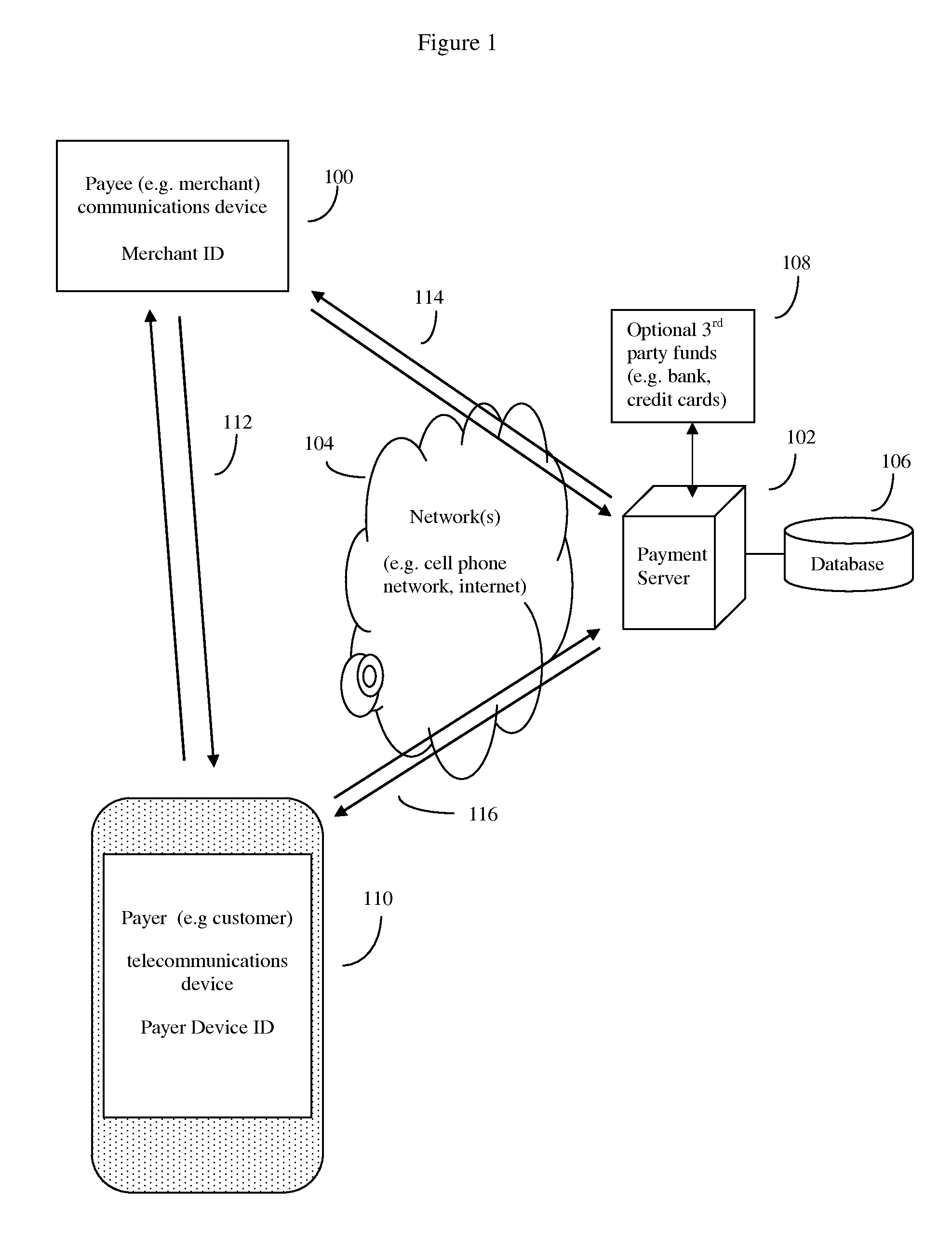

System and method of electronic payment using payee provided transaction identification codes

InactiveUS20130124364A1High degreeImprove conveniencePayment architectureBuying/selling/leasing transactionsPaymentFinancial transaction

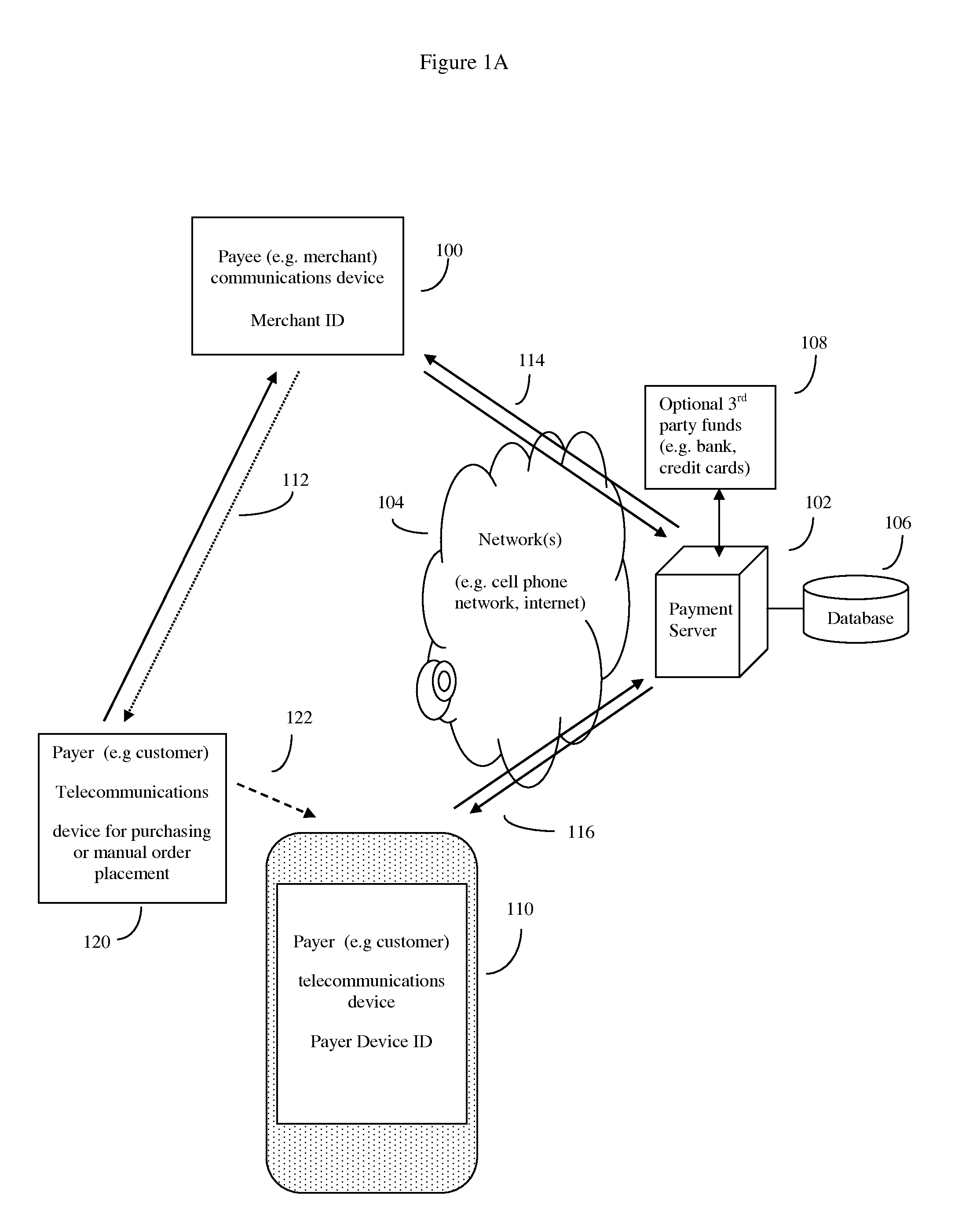

A computerized method of payment based on short, temporary, transaction ID numbers which protect the security of the payer's (customer's) financial accounts. The payee will first register a source of funds and a payer device with a unique ID (such as a mobile phone and phone number) with the invention's payment server. Then once a payee (merchant) and the payer have agreed on a financial transaction amount, the payee requests a transaction ID from the payment server for that amount. The payment server sends the payee a transaction ID, which the payee then communicates to the payer. The payer in turn relays this transaction ID to the server, which validates the transaction using the payer device. The server then releases funds to the payee. The server can preserve all records for auditing purposes, but security is enhanced because the merchant never gets direct access to the customer's financial account information.

Owner:MITTAL MILLIND

Communication device including multi-part alias identifier

ActiveUS20090281948A1Easy transferFinanceAutomatic call-answering/message-recording/conversation-recordingPaymentFinancial transaction

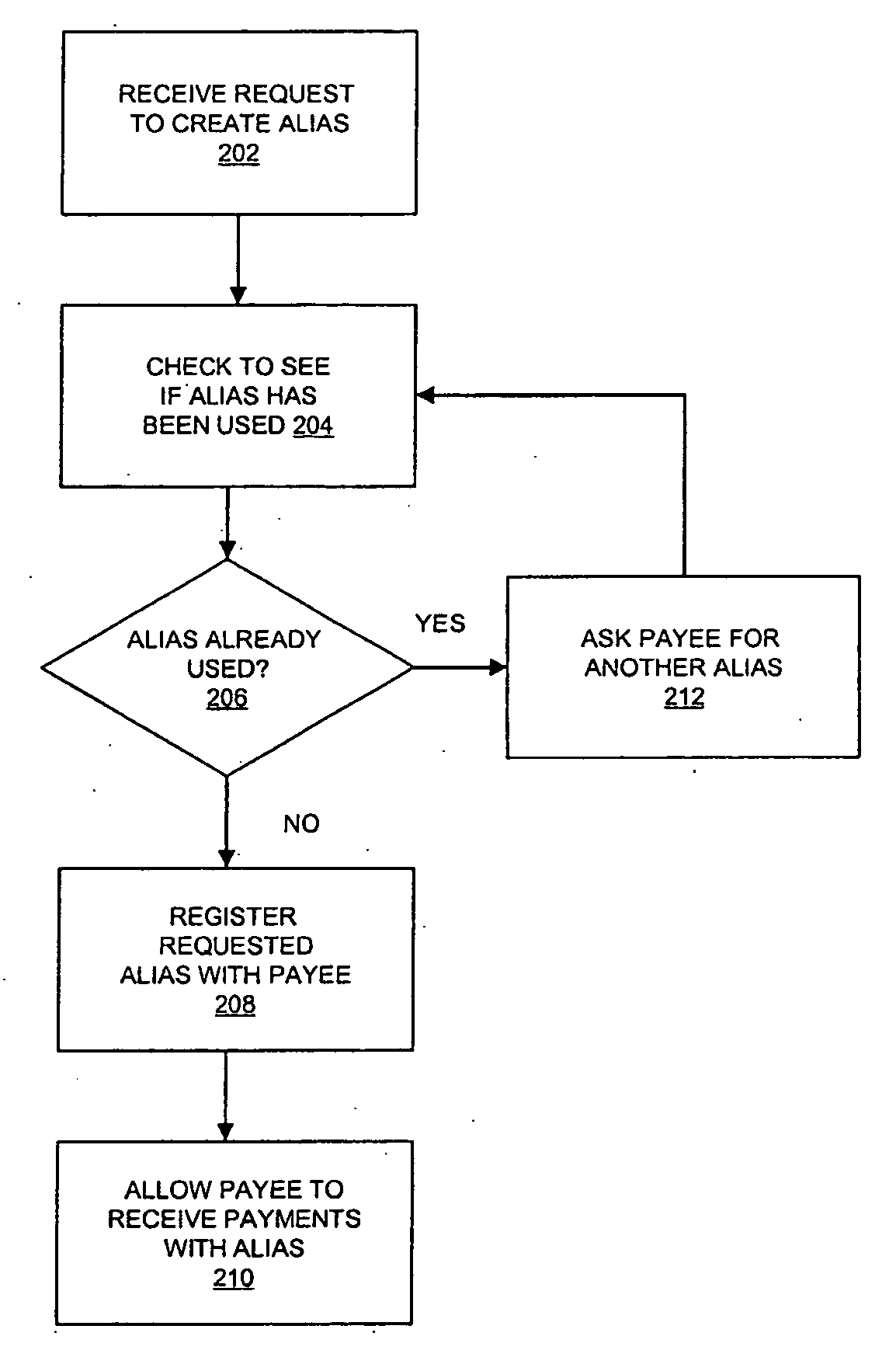

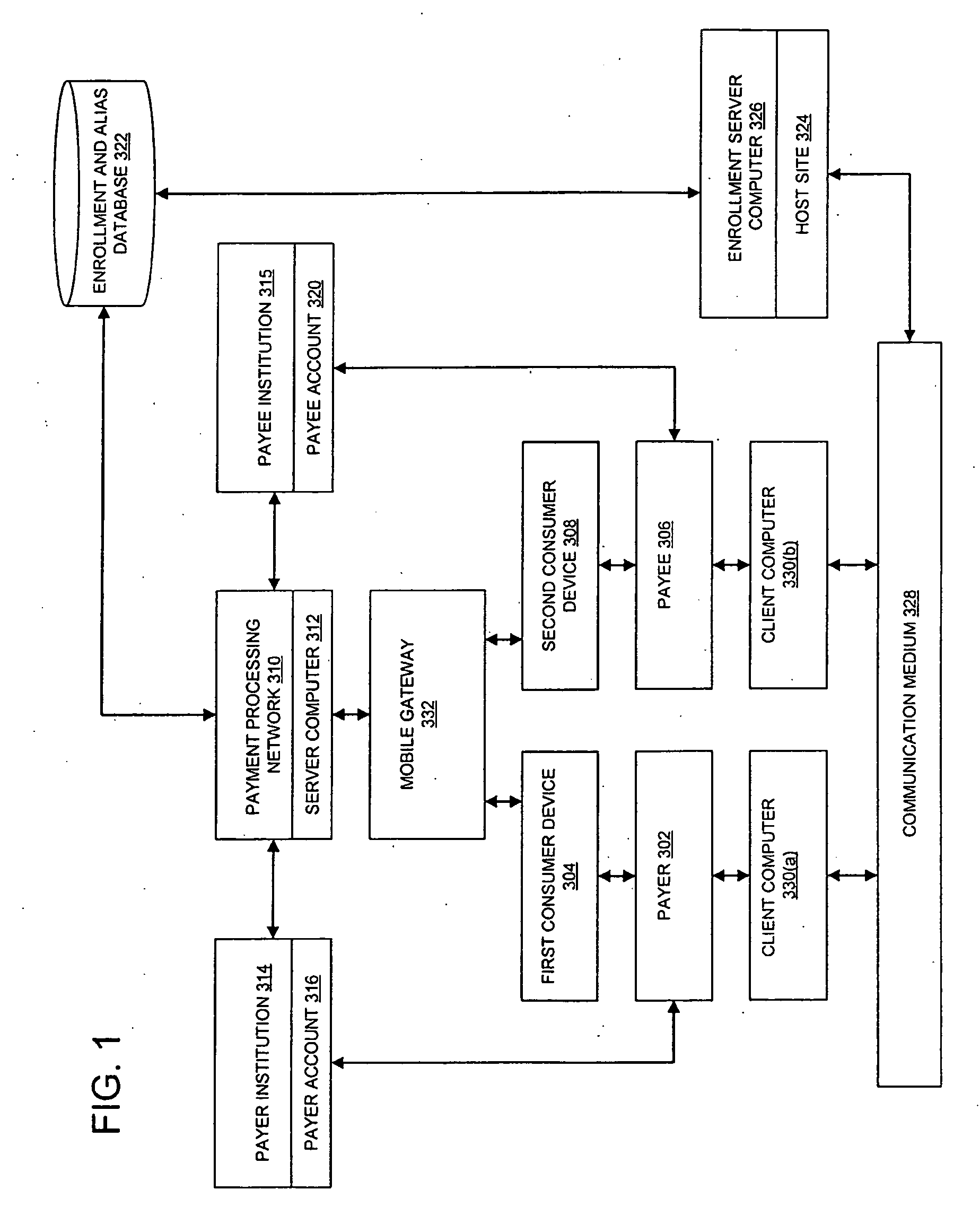

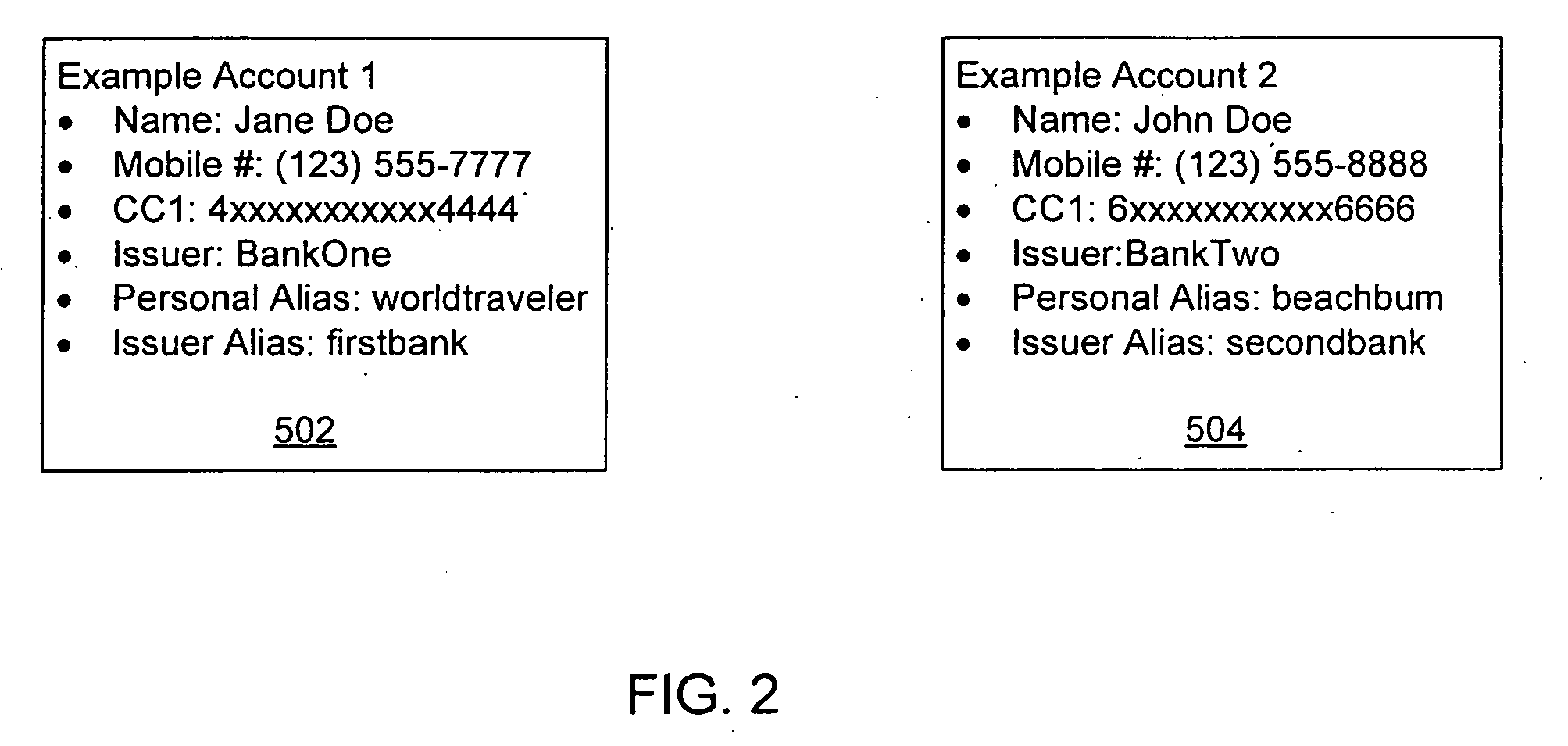

Methods and systems are disclosed for allowing financial transactions to be conducted using consumer devices. In some embodiments, the consumer device is a mobile communication device, such as a mobile phone. A payer initiates a transaction by sending a payment request message from a mobile phone which specifies the payee and amount to be paid. Payees are identified by unique aliases, which are maintained in a database. The aliases, in turn, are comprised of multiple parts. Each part of the alias may identify a relevant aspect of the transaction. For example, one part of the alias may identify the payee and another part of the alias may identify the financial institution of the account of the payee. Methods for assembling the enrollment and alias database are included.

Owner:VISA INT SERVICE ASSOC

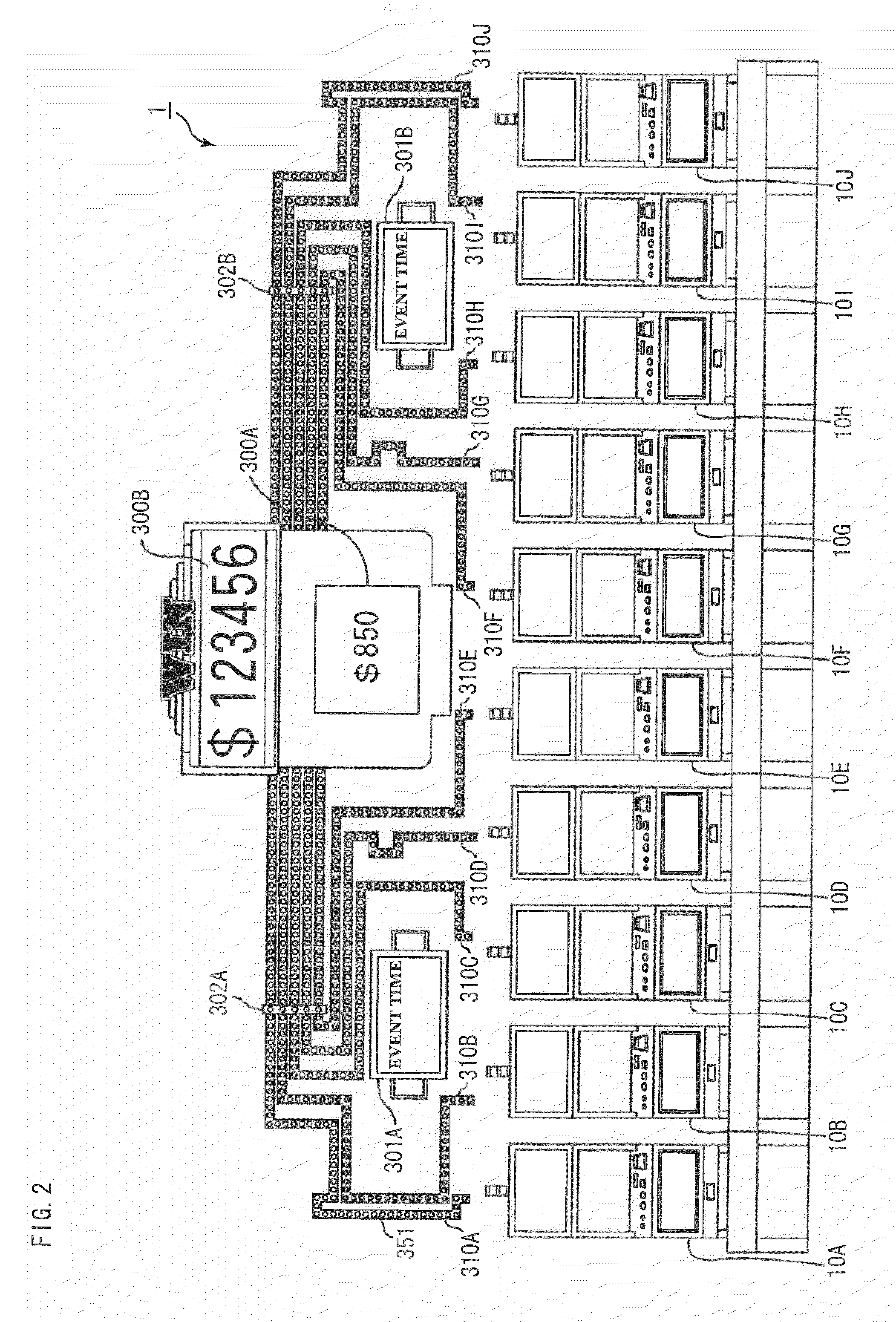

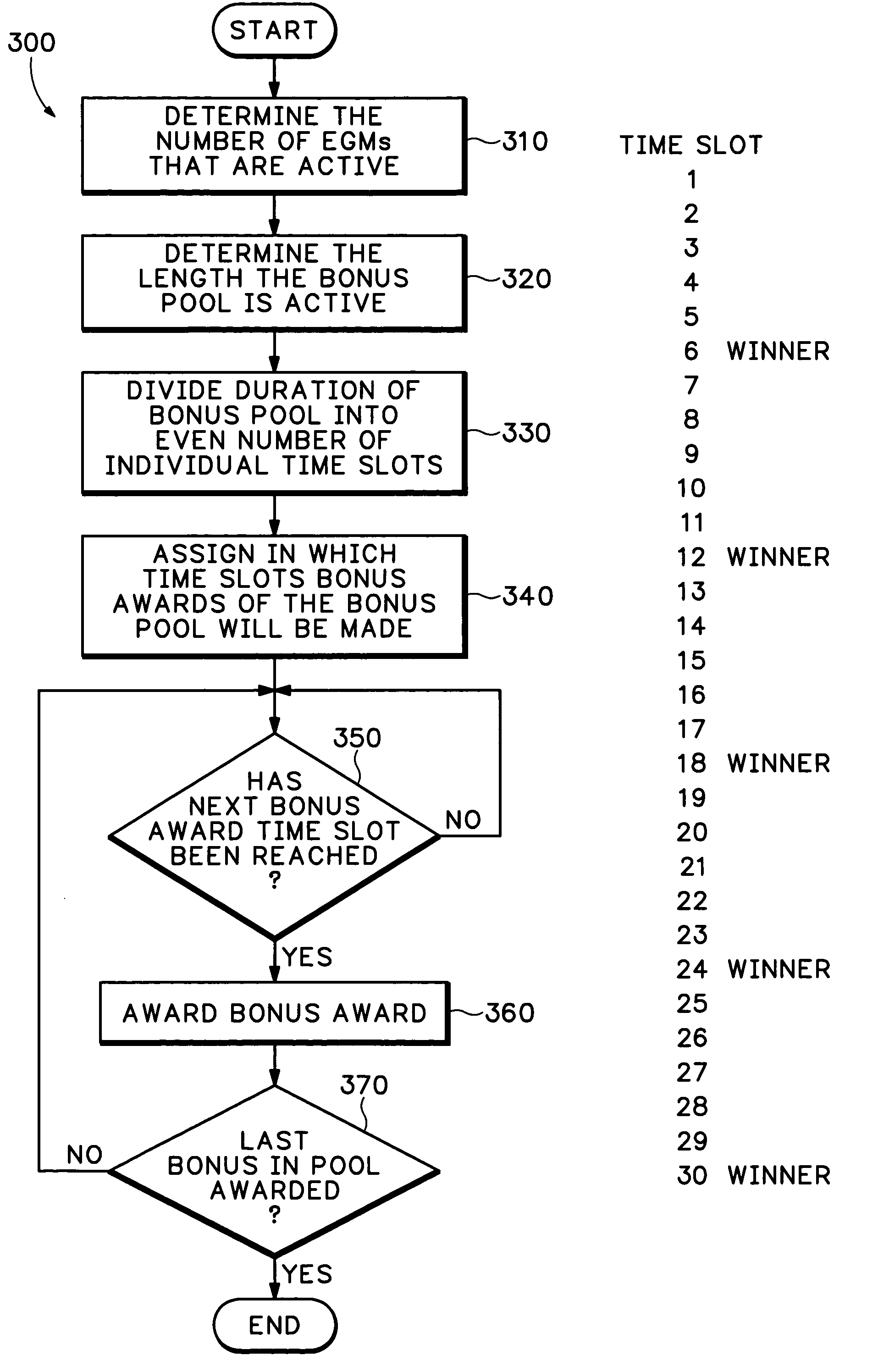

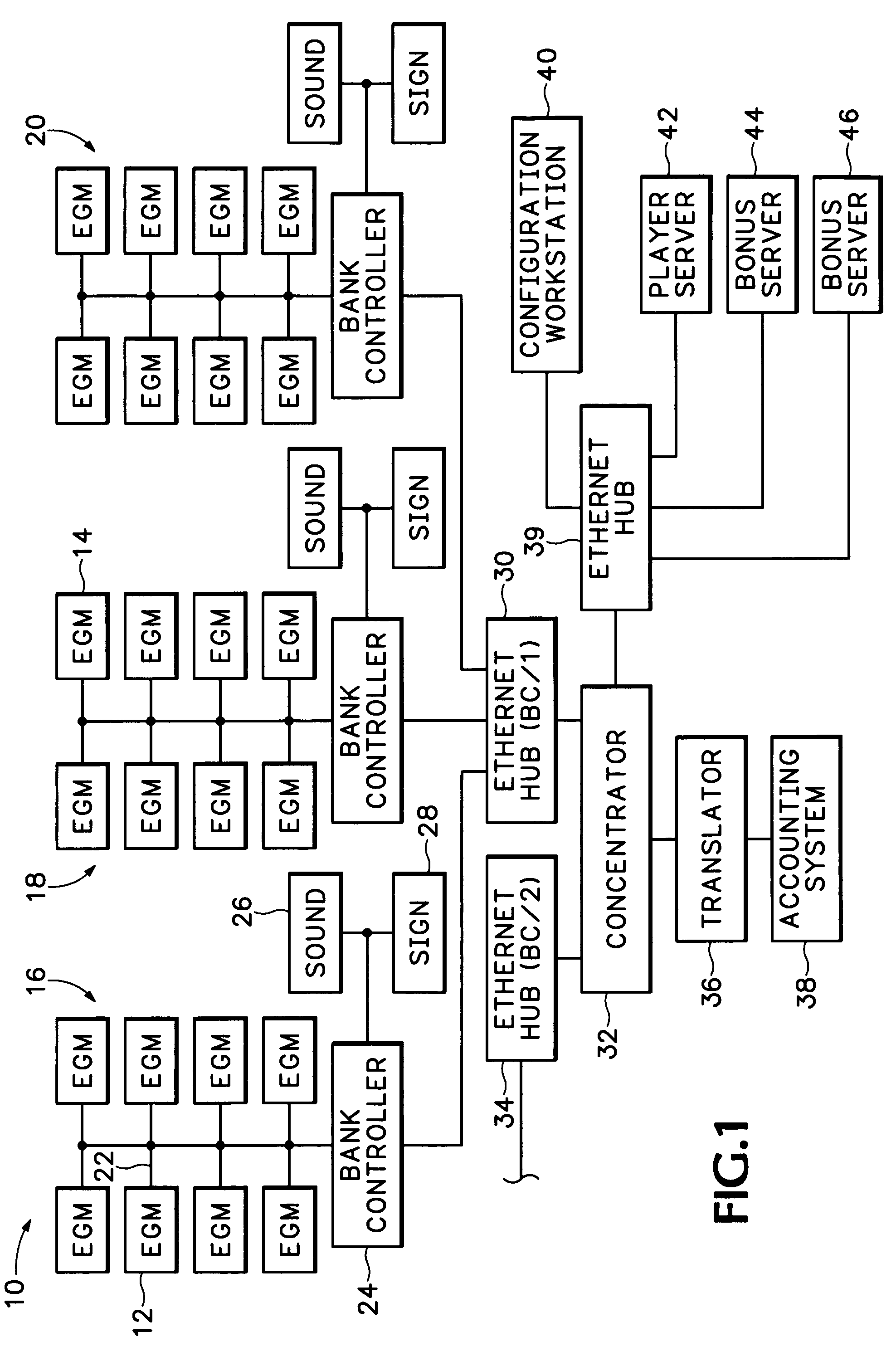

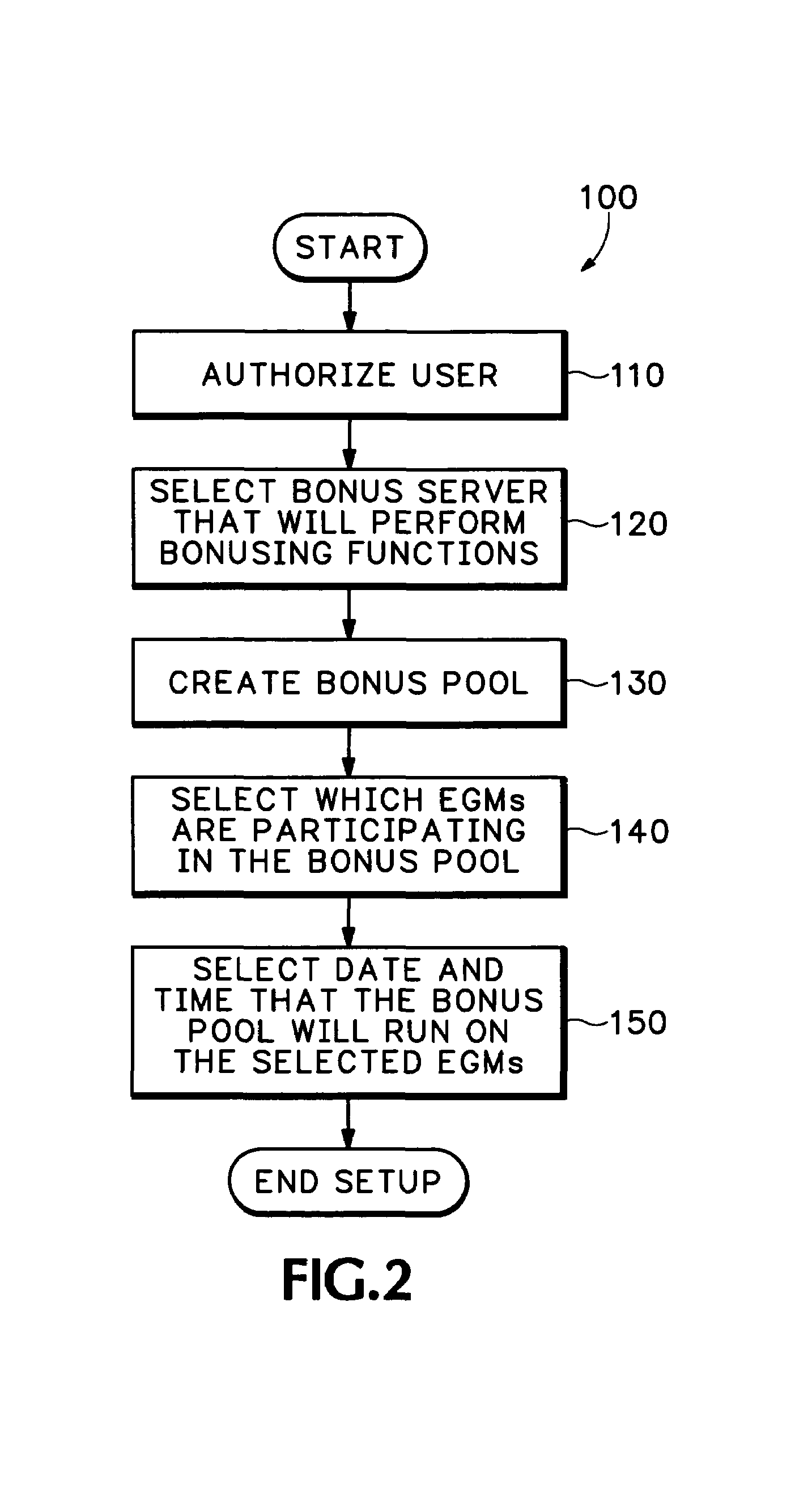

Method and apparatus for awarding a bonus on a network of electronic gaming devices during a pre-determined time period

Embodiments of the invention provide a time-based bonus system that can be pre-configured to award a certain amount of money to players of networked gaming devices over a certain time period. The amount of bonus money in a bonus pool is predetermined by a casino or other gaming network operator. Additionally, the total amount of bonus money in a particular bonus pool can be divided into multiple smaller bonuses, which can be distributed to many players over the time period in which the bonus pool is operating.

Owner:IGT

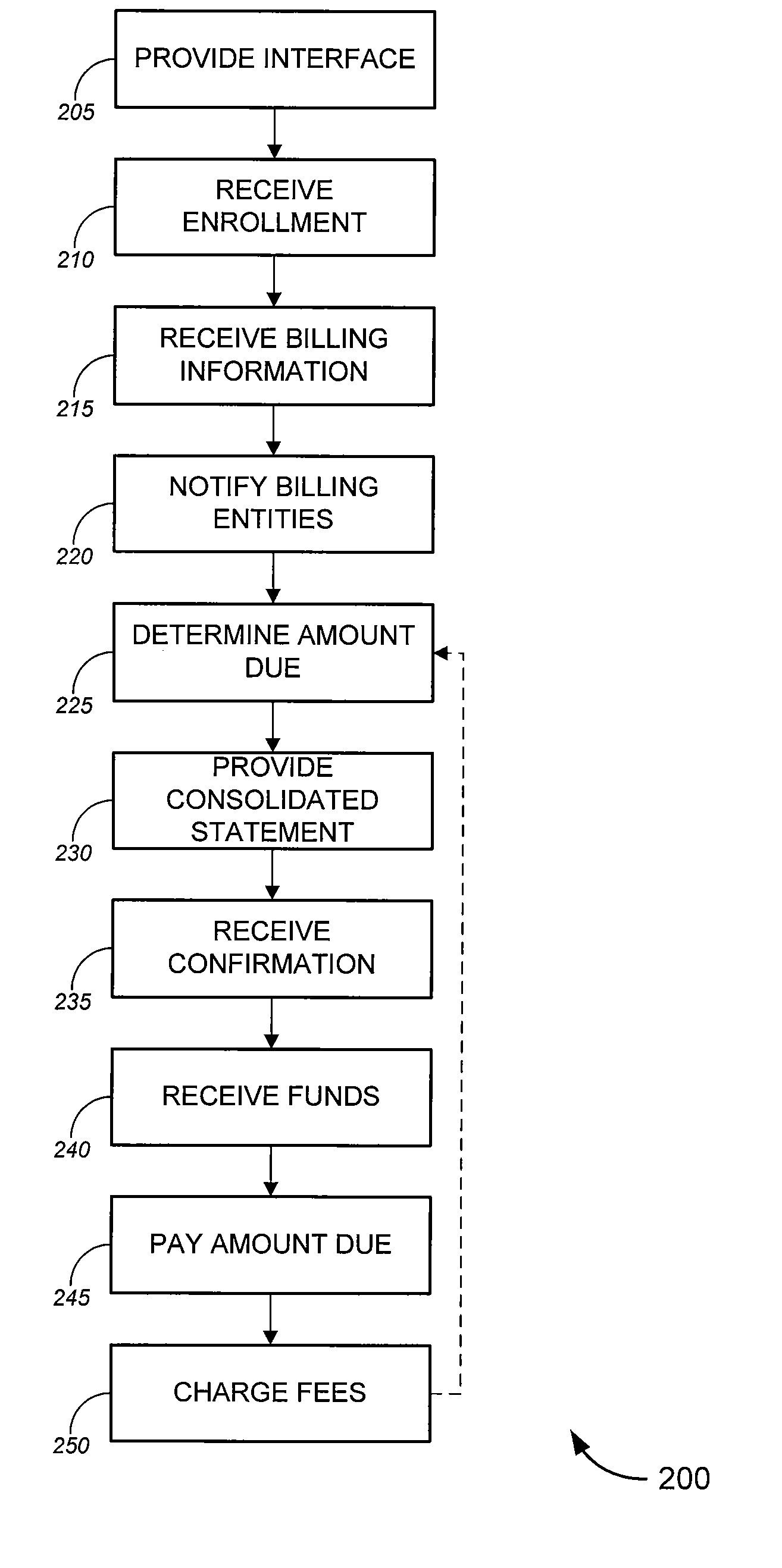

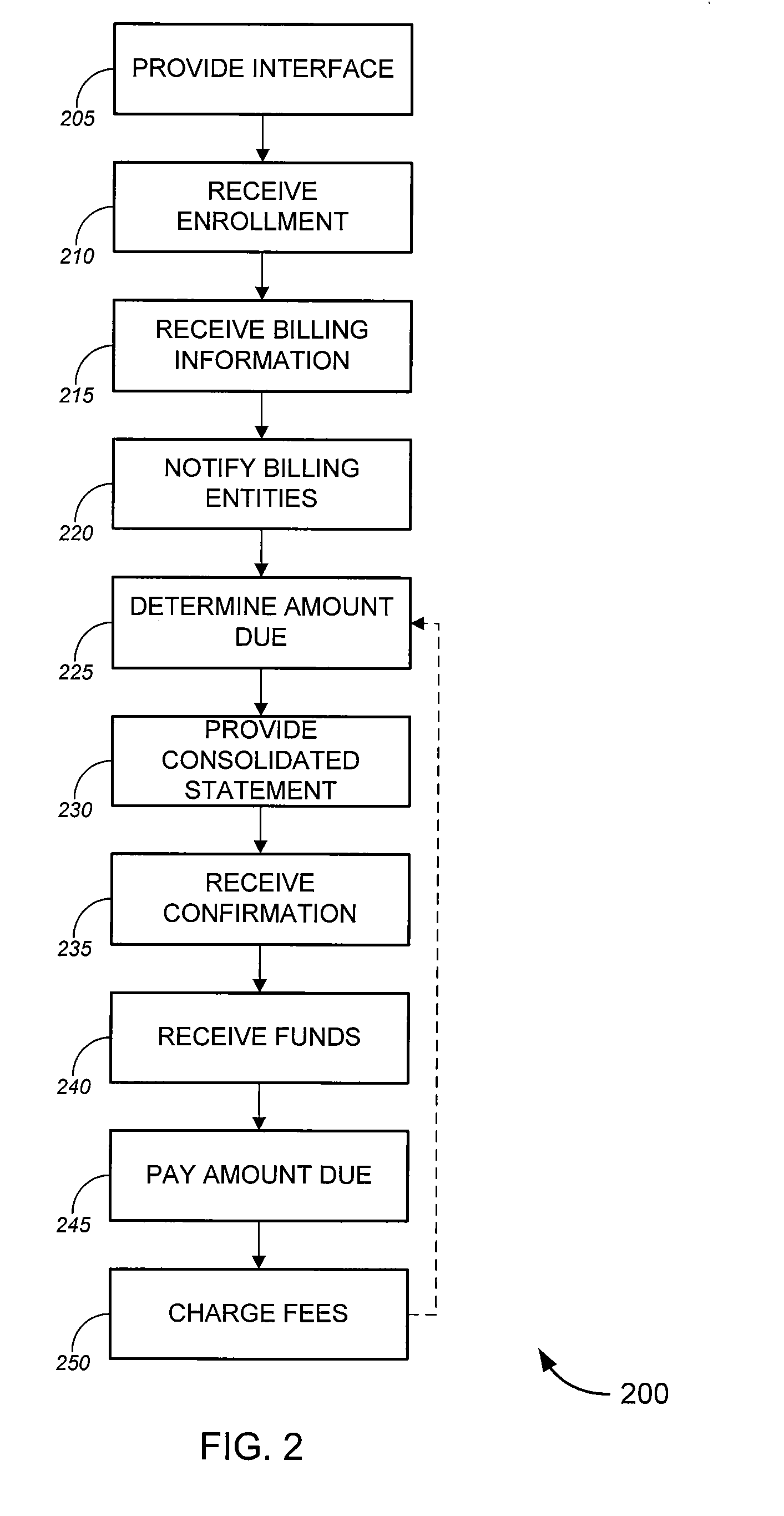

Bill payment aggregation service

ActiveUS20090089193A1Avoid traditional hassleRelieve stressComplete banking machinesFinancePaymentLevel of detail

Tools for providing bill aggregation and / or payment services. In an aspect, such tools aggregate all payments over a given period of time, allowing a user to make a single payment to ensure that all appropriate bills are paid in timely fashion. In another aspect, the tools determine, without requiring user input, an amount due on each bill, as well, in some cases, of a due date for each payment. Optionally, the tools can provide a consolidated statement to inform the user of payments to be made over a given period. Such statements can provide a varying level of detail, depending on the implementation and / or on user preferences. In some cases, a consolidated statement might provide line items and / or detailed support for each payment to be made. In other cases, the consolidated statement might simply provide a single consolidated payment amount.

Owner:THE WESTERN UNION CO

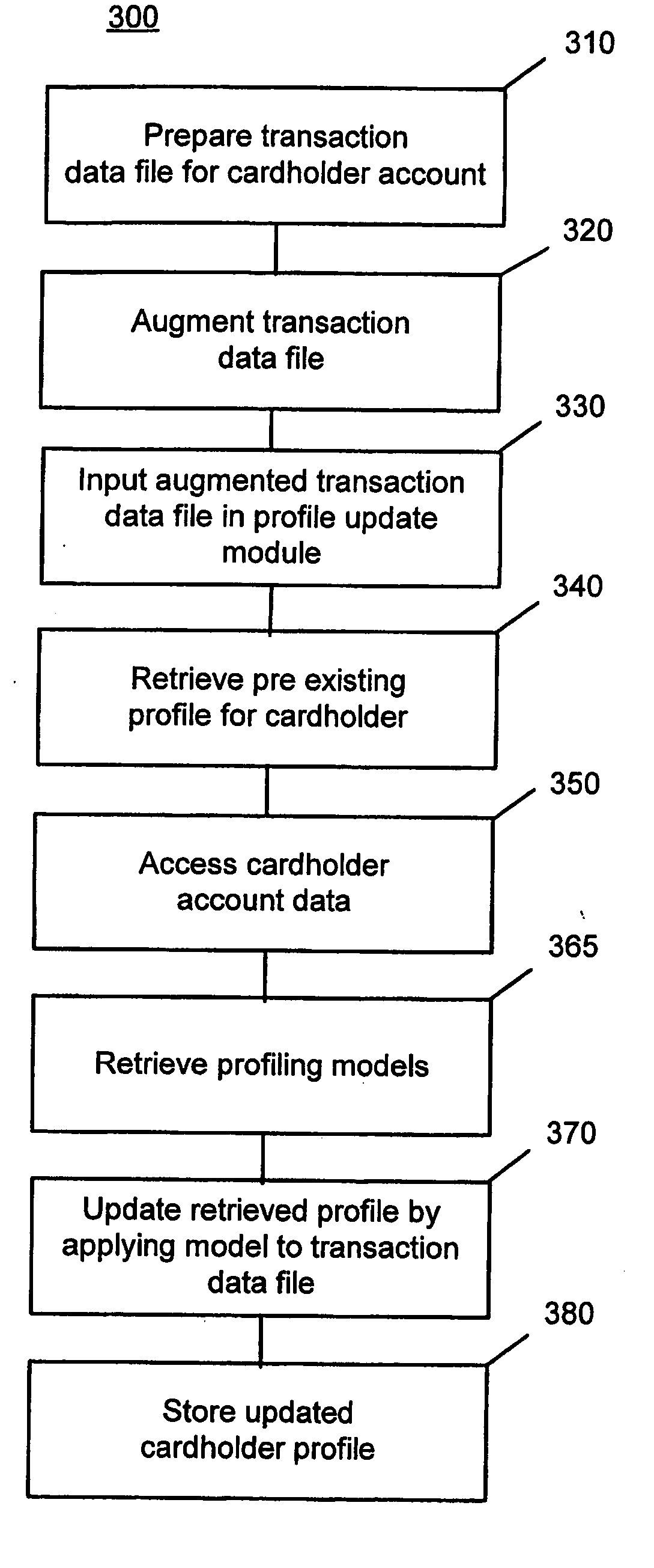

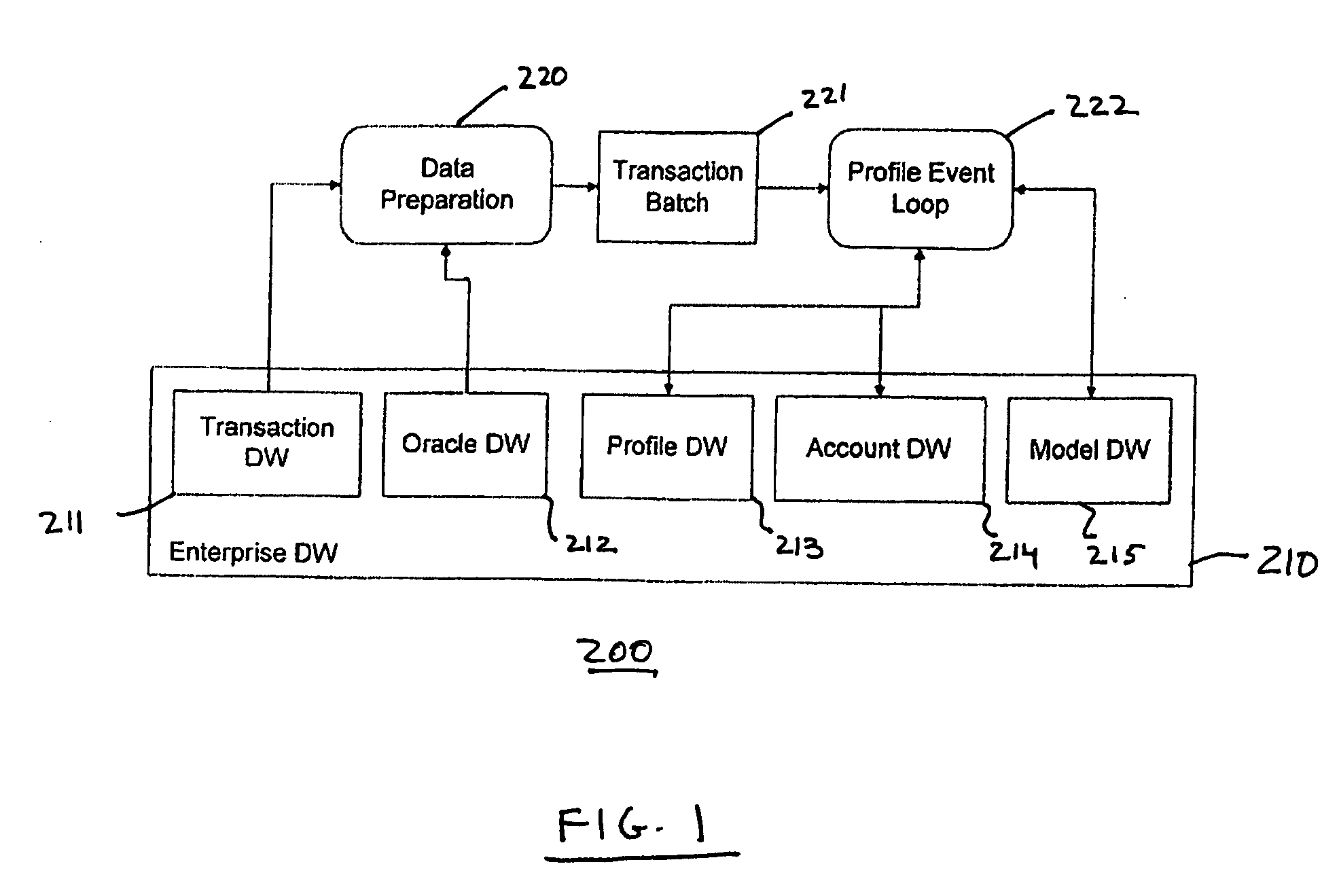

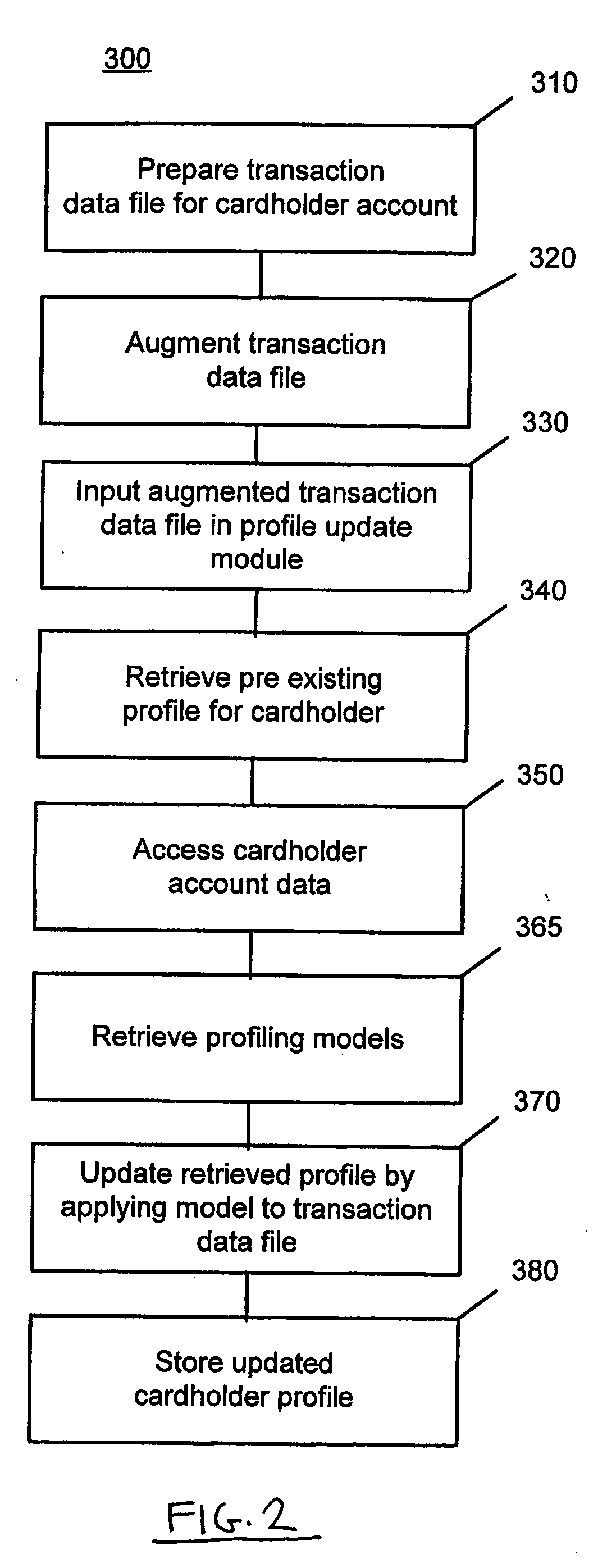

Methods and systems for predicting business behavior from profiling consumer card transactions

A system and method are provided for predicting small business behavior by analysis of consumer payment card transaction data. Transaction and amount velocity analysis of industry categories and / or real-time transaction-based profiling is employed to identify those consumer payment card accounts that are being inappropriately used to make small business purchases. A small business behavior predictor model is used to score transaction data and update cardholder profiles according to the likelihood that the transaction data represents small business activity.

Owner:MASTERCARD INT INC

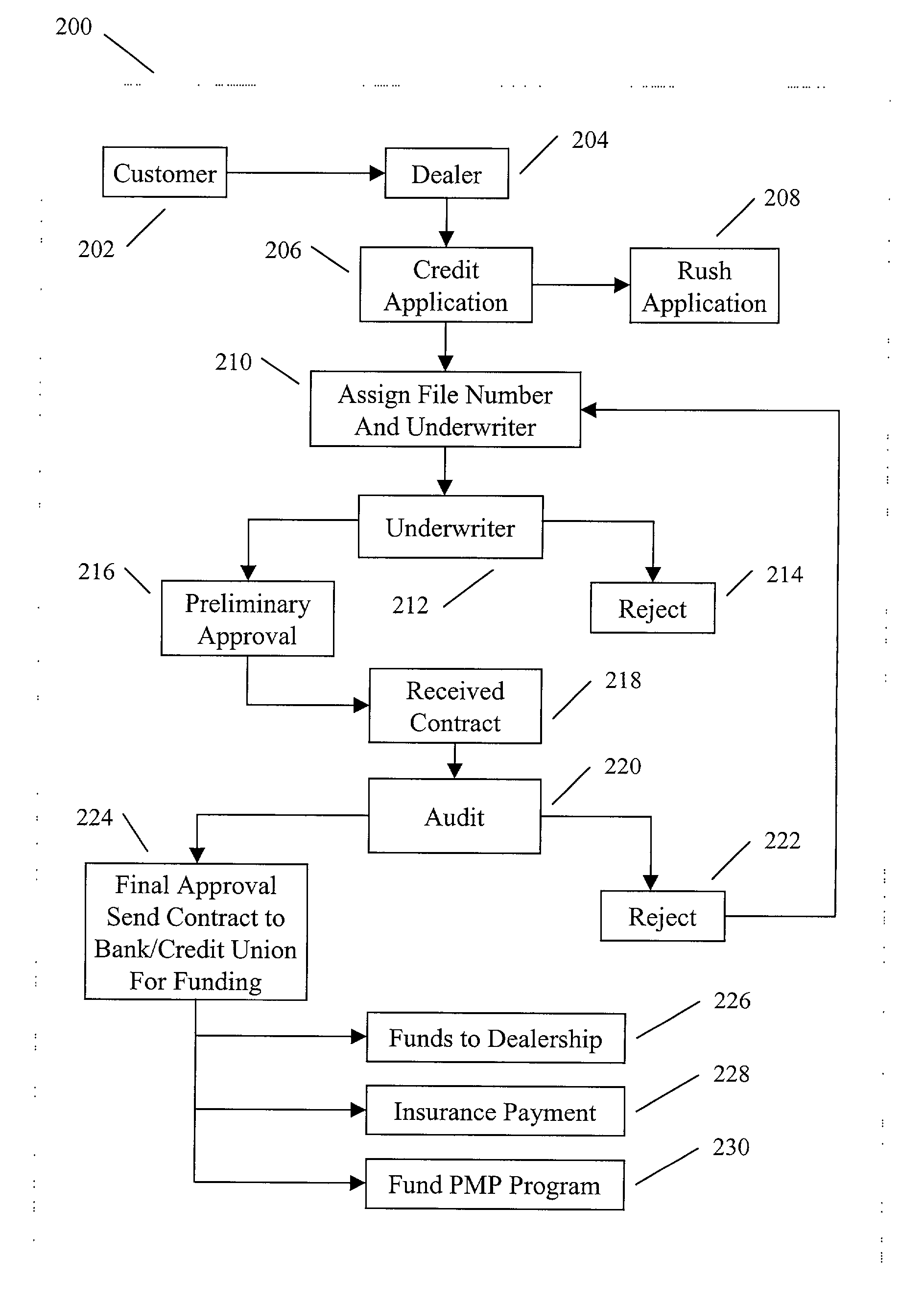

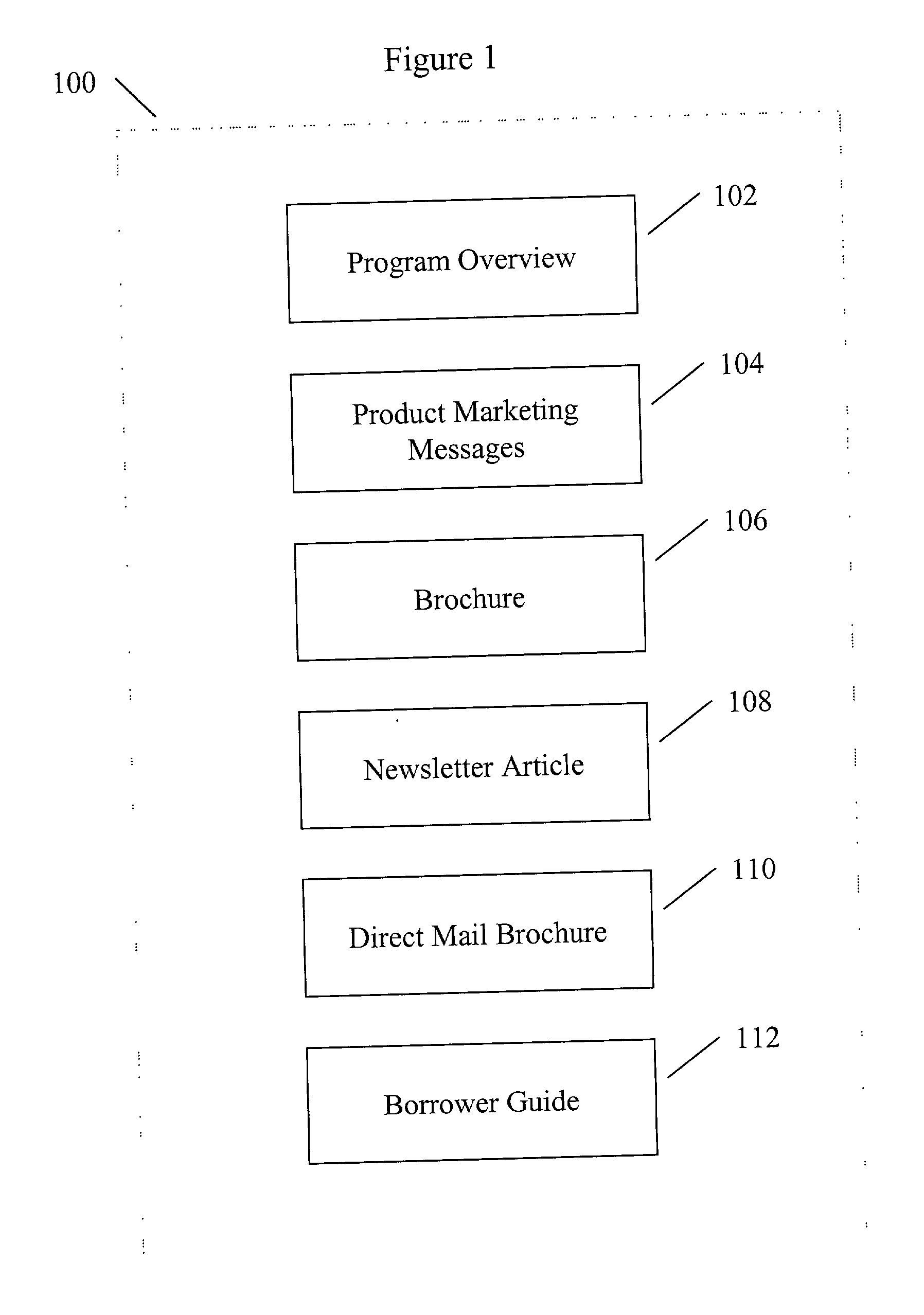

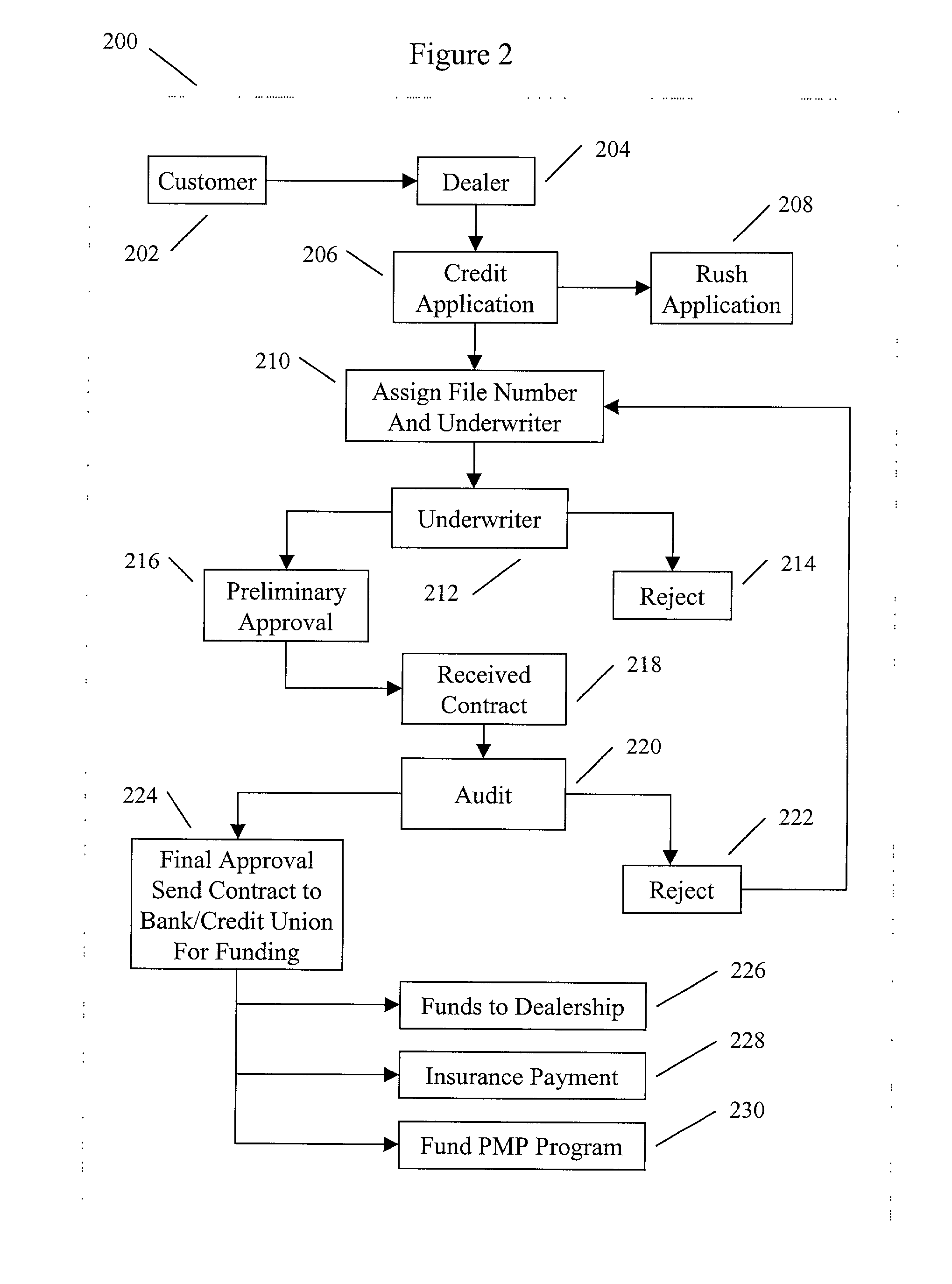

Method for providing financial and risk management

InactiveUS20020019804A1Reduce riskIncrease revenue generationFinancePayment architectureTime limitComputer science

A method for marketing, assessing, underwriting, insuring and managing loans comprising marketing information and training for financial institutions, criteria for employment, credit history, and loan property type, insurance for loss limited by a predetermined amount, and tracking and servicing of a loan including collection and liquidation in the event of default. The invention further comprises status reporting, and liquidation of loans prior to expiration of the term of a loan.

Owner:WK CAPITAL ADVISORS

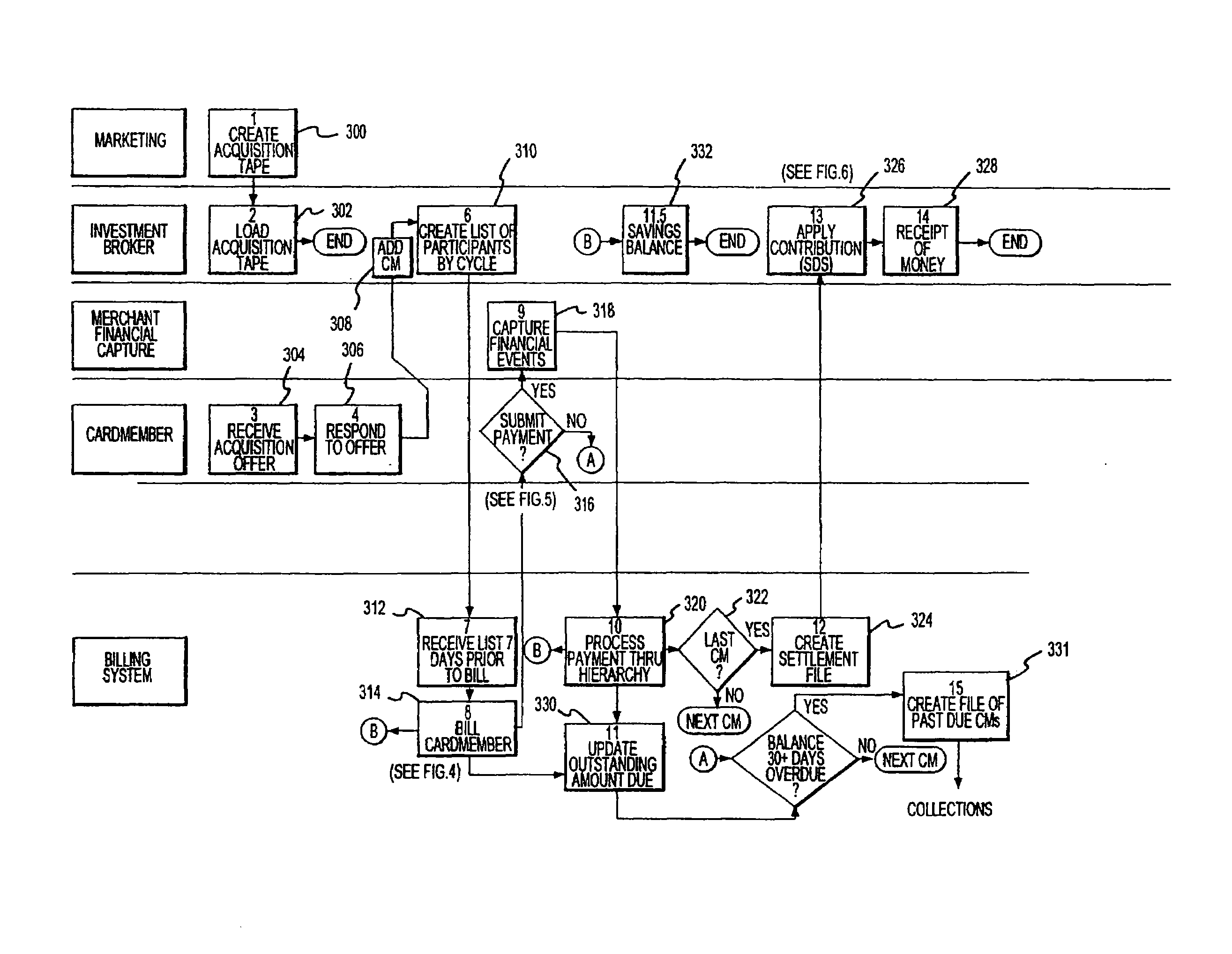

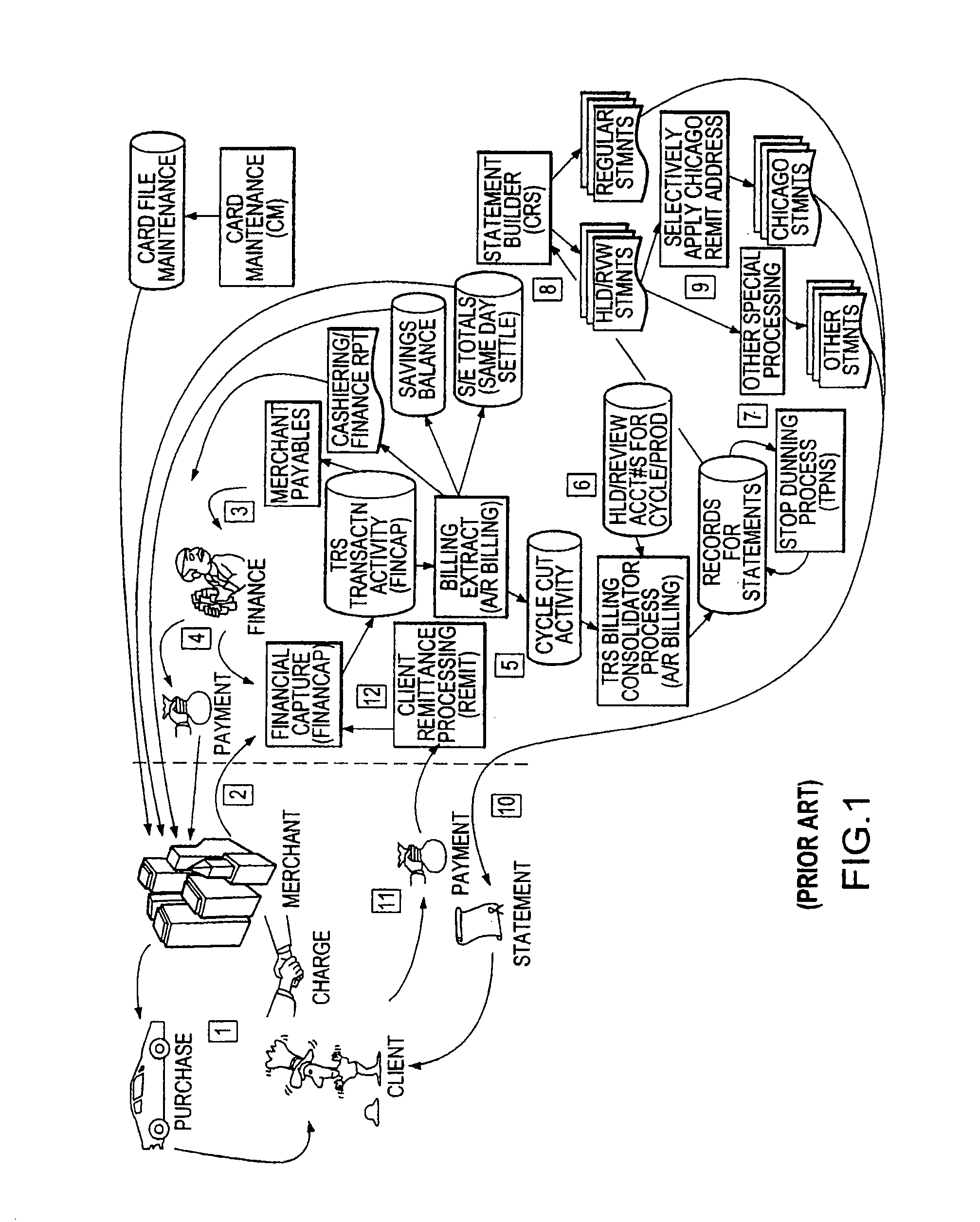

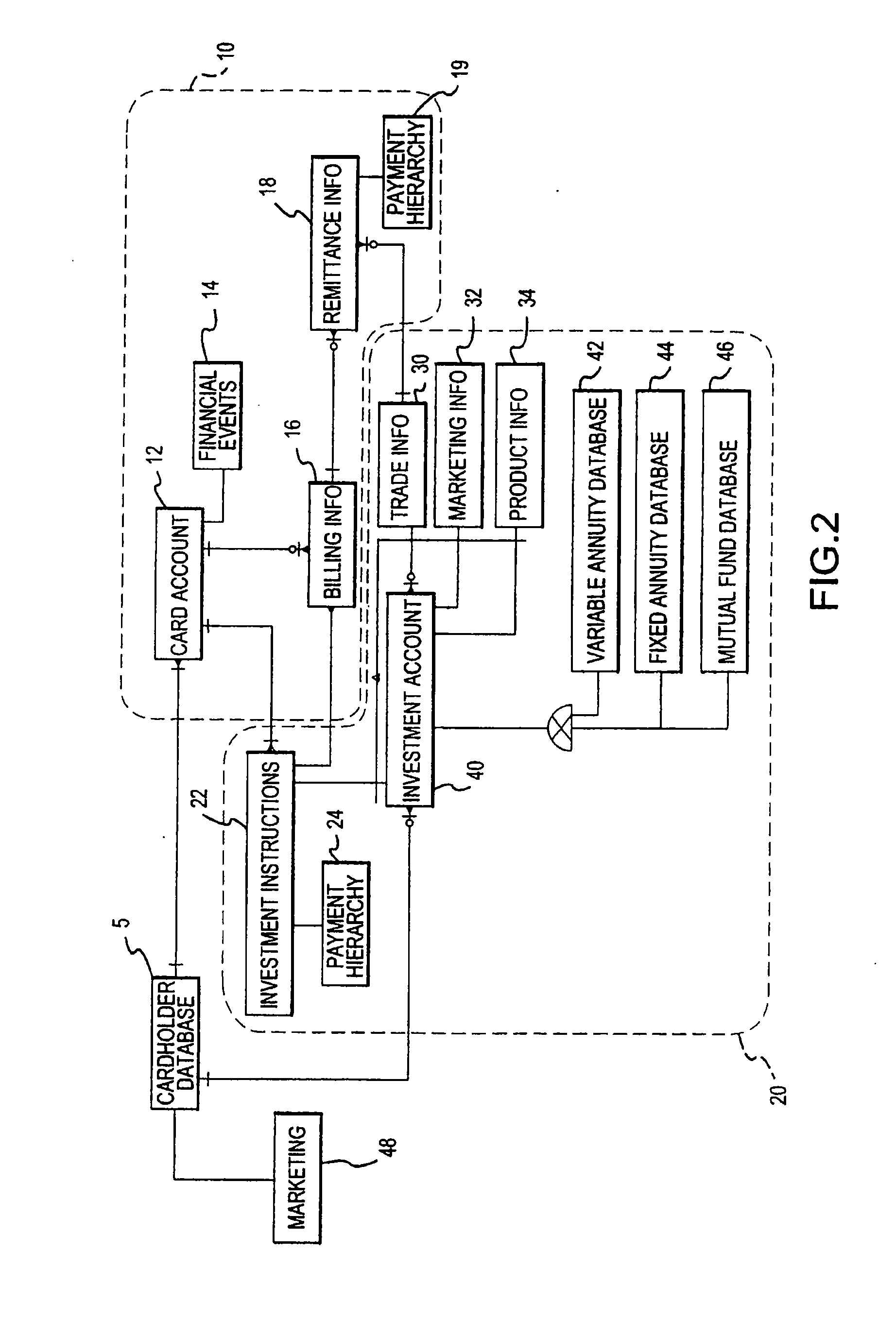

System and method for dividing a remittance and distributing a portion of the funds to multiple investment products

A known charge card billing system communicates with an investment broker system, wherein the investment broker system includes an instruction arrangement database, payment hierarchy and an investment account. An interested cardholder suitably appoints the charge card administrator as a processing agent to collect and promptly remit the cardholder's voluntary, periodic payments for investment into preselected investment products, such as, for example, mutual fund shares, fixed annuities, variable annuities, CDs, insurance, certificates, equities and / or the like. The billing system distributes a billing statement at the end of each month, wherein the statement includes all of the charges for that month and a reminder to remit an additional dollar amount for the preselected investments. The cardholder then sends a single payment for the charges and the investments to the charge card administrator. After receiving the payment, the system appropriately unbundles the payment and distributes the remitted payment to the card account to satisfy the captured financial events and to the investment broker system for the purchase of investment products.

Owner:AMERIPRISE FINANCIAL

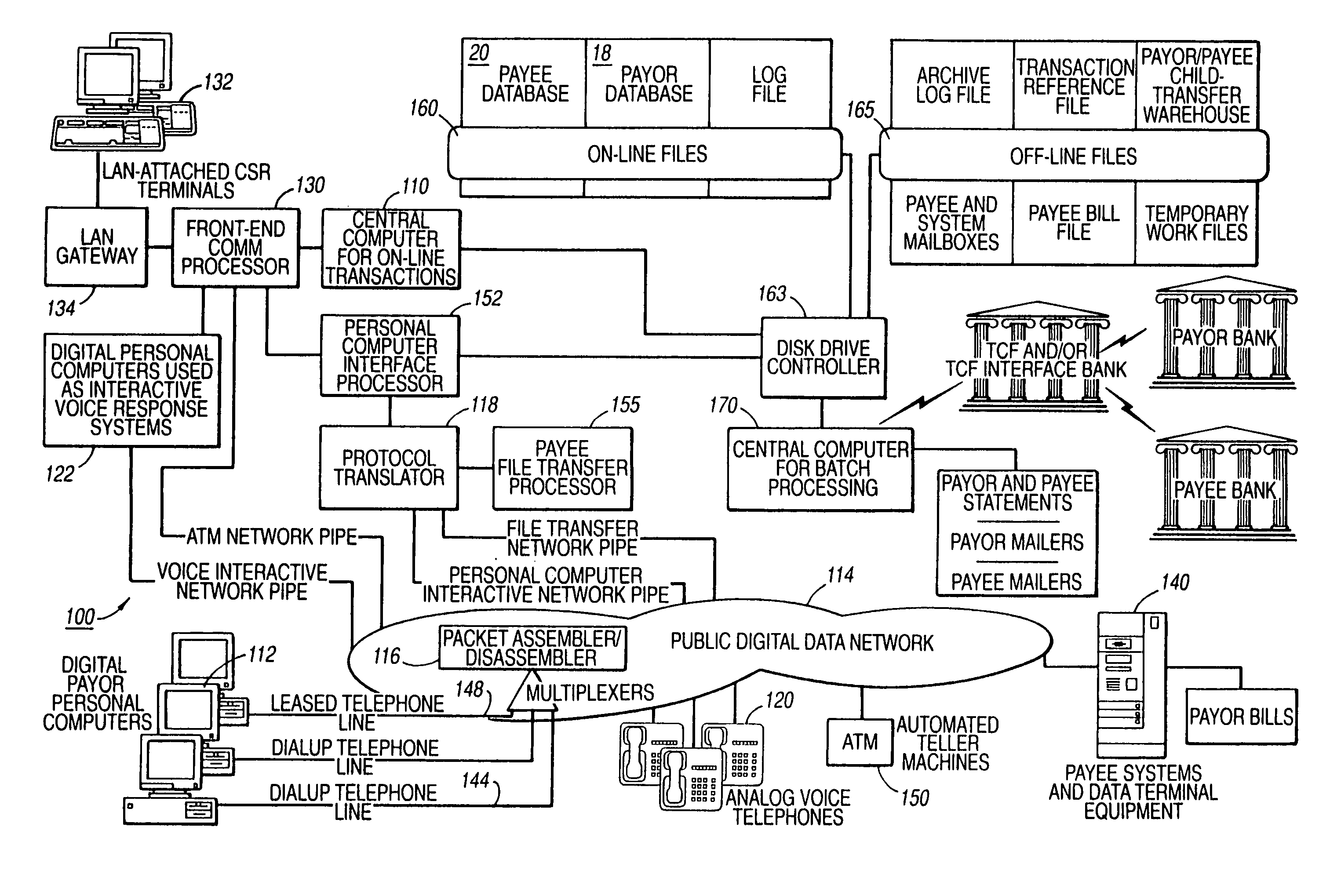

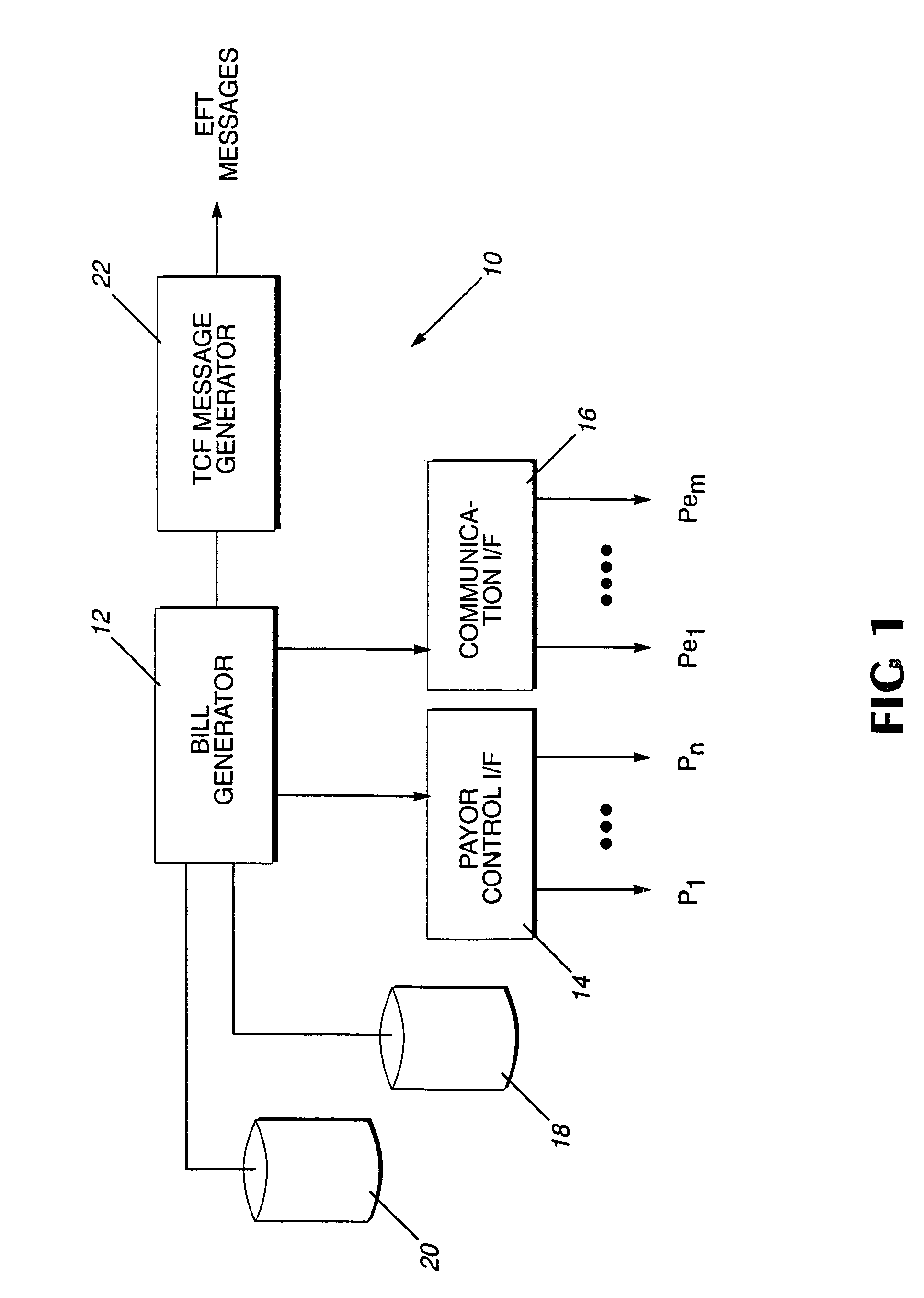

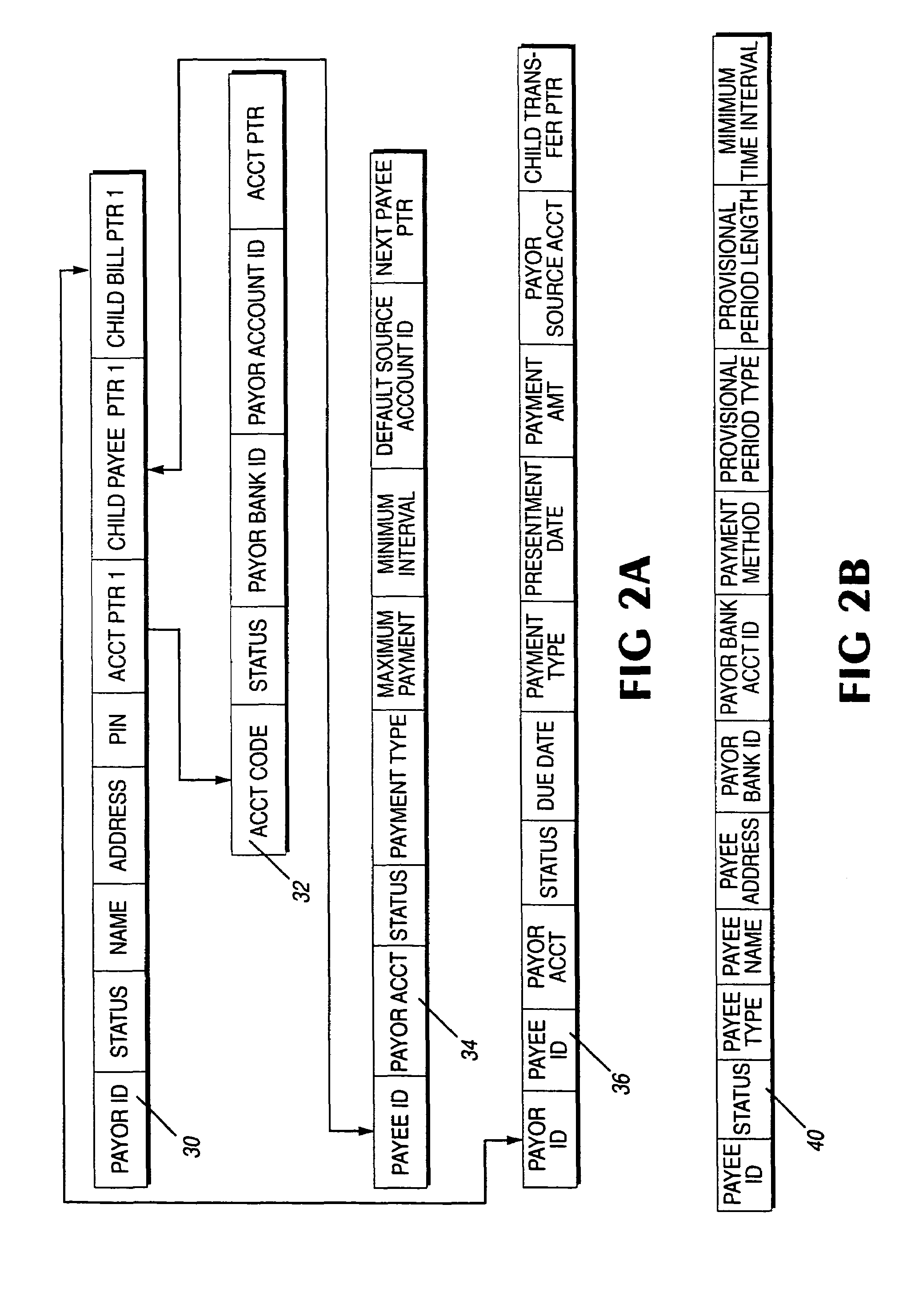

System and method for paying bills and other obligations including selective payor and payee controls

InactiveUS6996542B1Efficient implementationExtensive controlComplete banking machinesFinancePaymentDatabase

A system and method for paying bills without requiring interaction with the payors disclosed. The system includes a payor control interface, a communications interfacee, a bill generator, and a TCF message generator. The bill generator generates bill records from payor and payee information stored within the system for recurring bills. The bill generator may also generate bill records from the payor and payee information and from bill data messages received from payees. The generated bill records are used by the TCF message generator to generate the EFT messages for transferring funds electronically between payors and payees. Payors may alter the payment amount and date for a bill as well as reverse payment of a bill already paid. Payees are also able to alter recurring bill records or may present bill data so that bill records reflecting variable obligation amounts may be generated.

Owner:WORLDPAY LLC

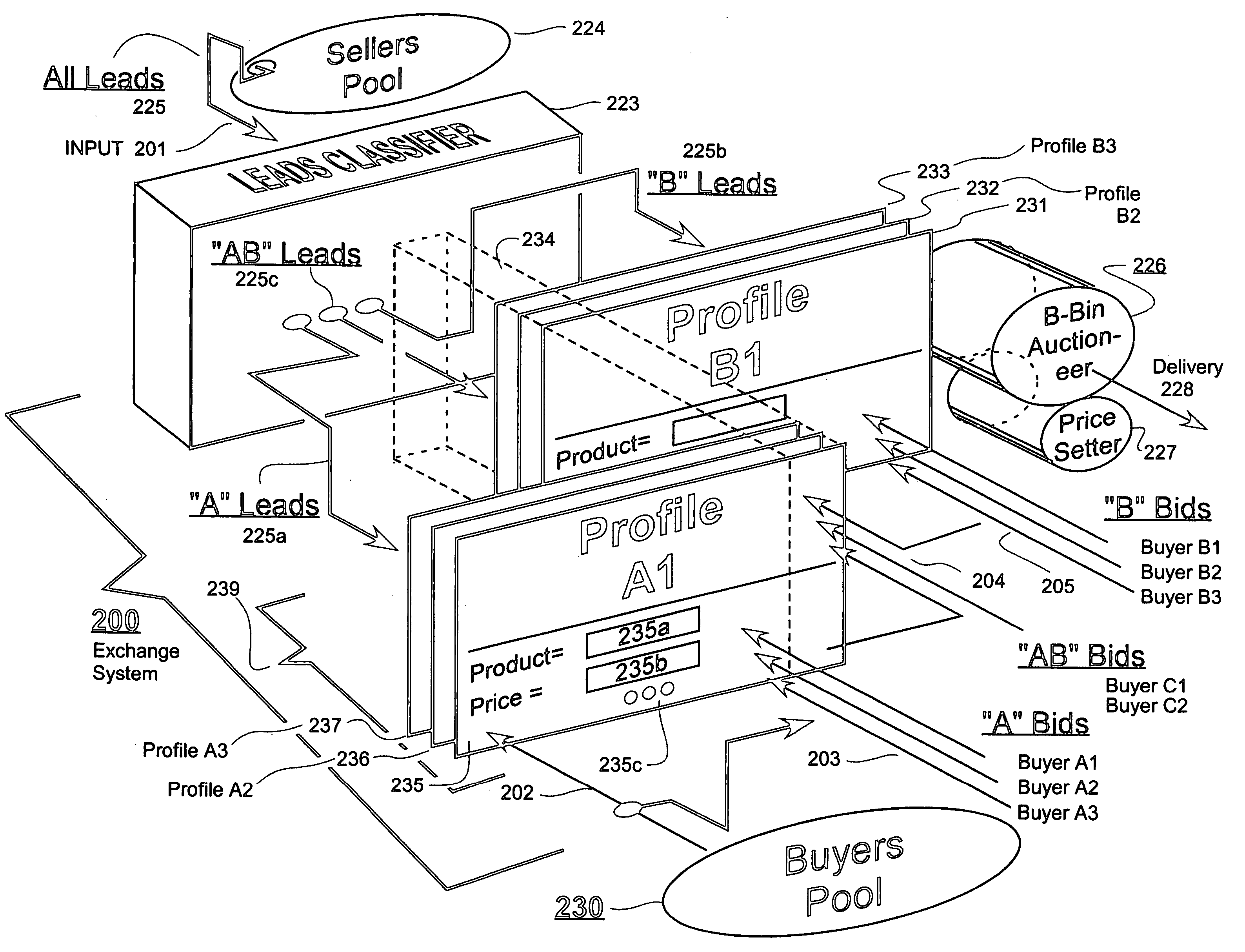

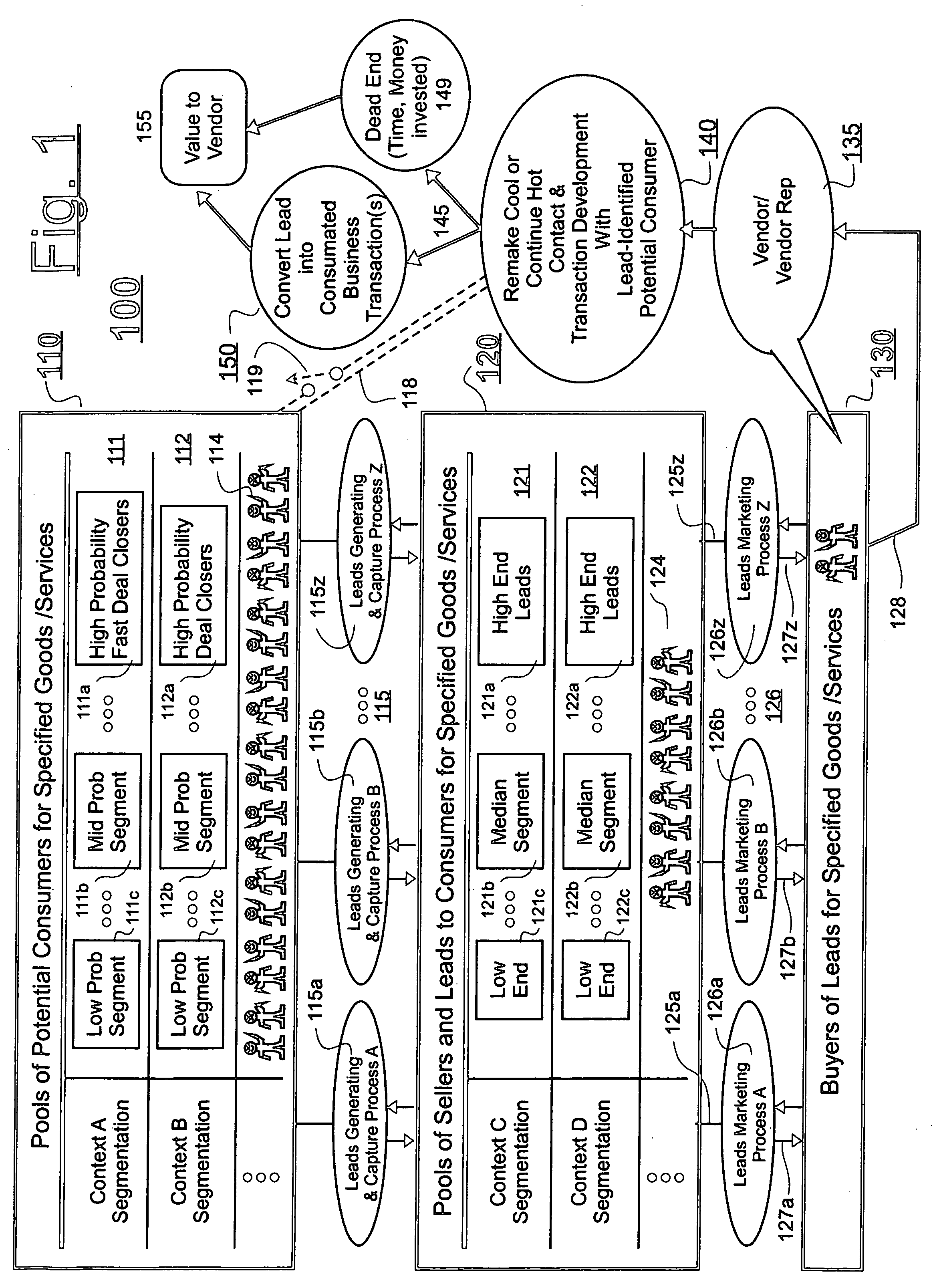

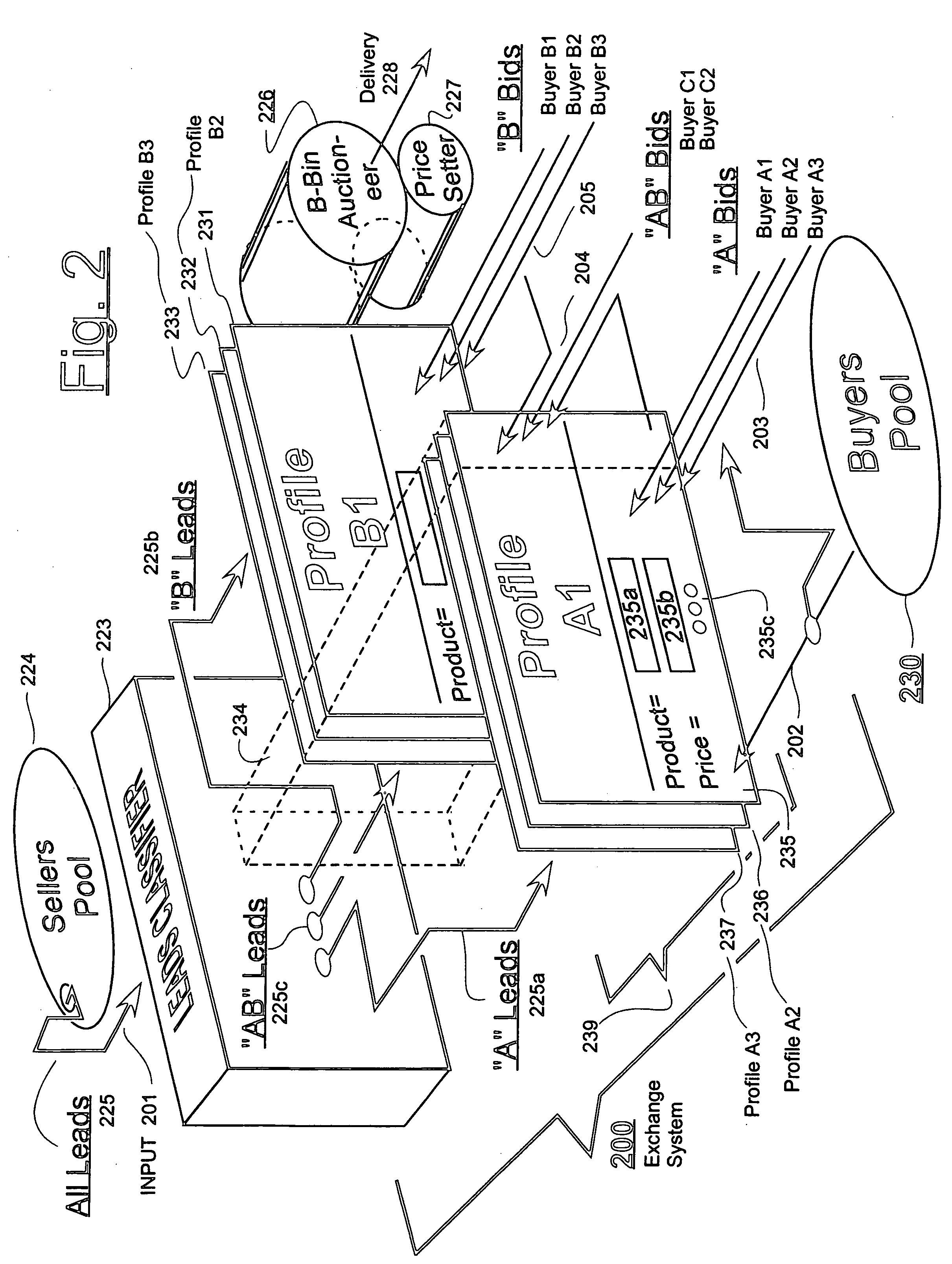

System for implementing automated open market auctioning of leads

ActiveUS20060041500A1Reduce probabilityMaximize auction-generated revenueFinanceCommerceQuality ratingEngineering

In an automated leads-and-bids exchange system, bid profiles are defined to describe desires of lead buyers. Received leads are matched to active ones of the bid profiles whose specifications the leads substantially match. An auctioning subsystem finds the highest one or group of bids for each given lead. A quality rating database rates the quality of leads provided by different sellers. A price discounting engine discounts the amount paid to sellers who are rated as inferior sources of leads.

Owner:LEADPOINT

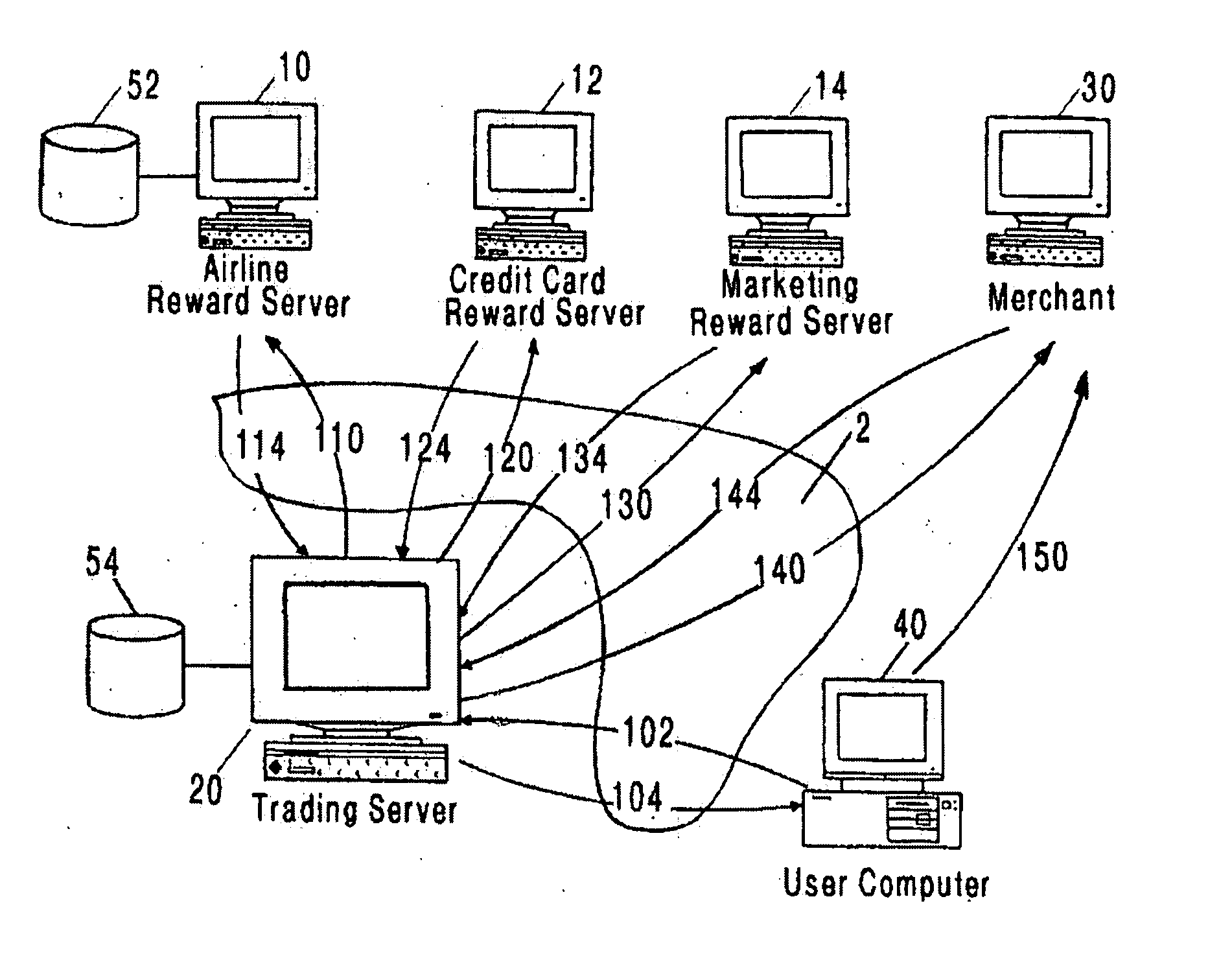

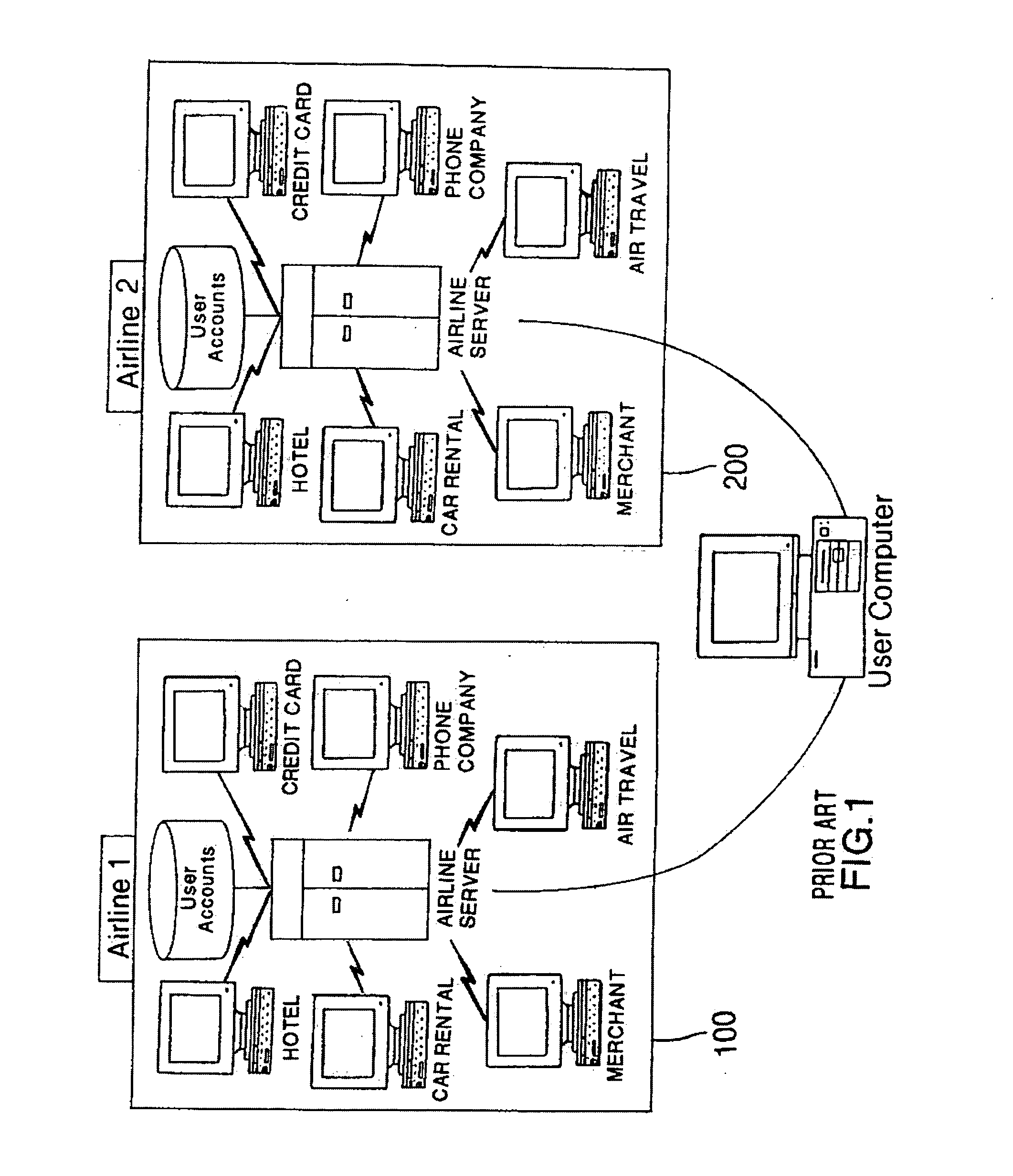

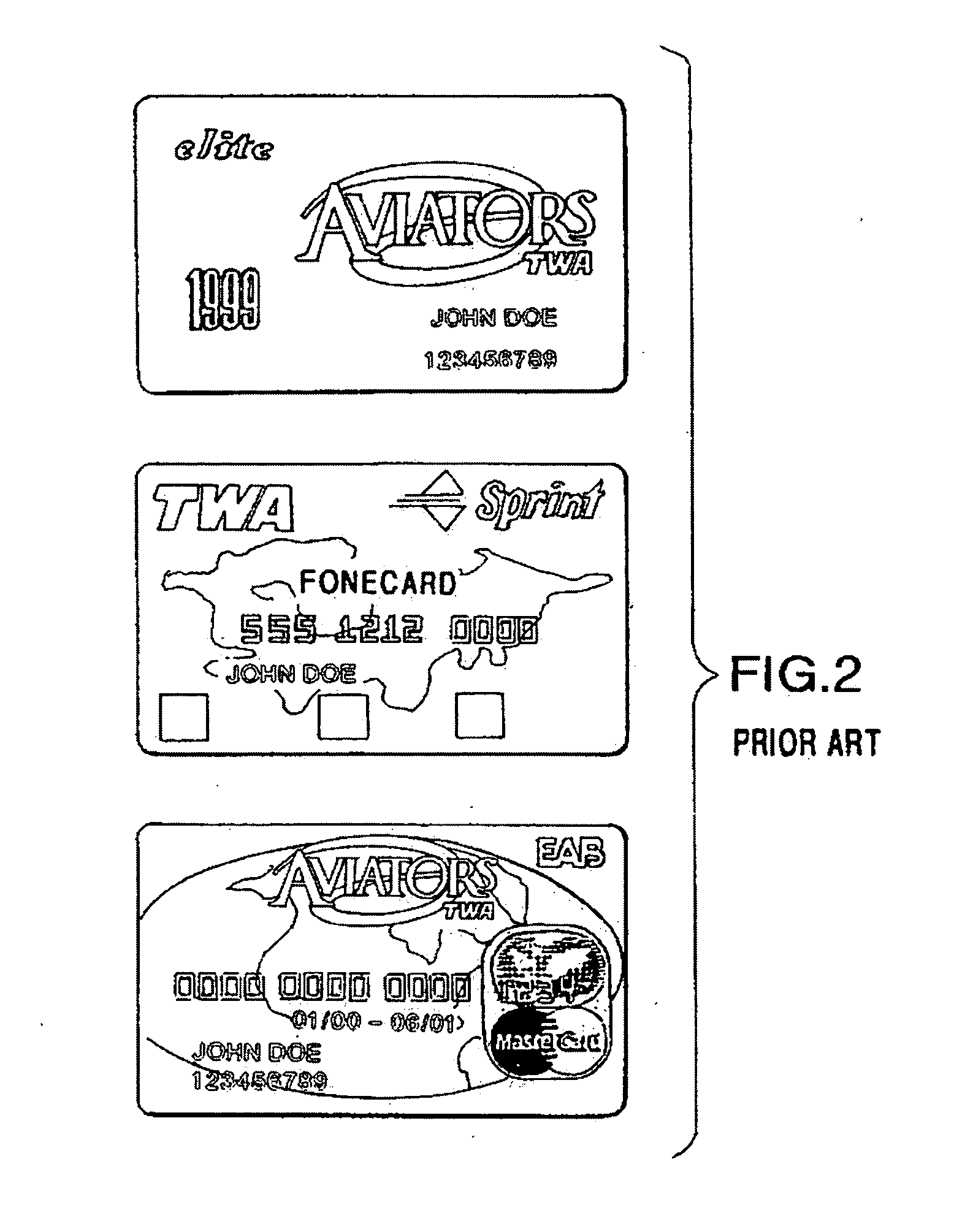

Method and system for issuing, aggregating and redeeming points based on merchant transactions

A loyalty or reward point system that utilizes the pre-existing infrastructure of a typical credit card network. In one embodiment, a user makes a purchase at a merchant of a product using a credit card. The merchant contacts the acquiring bank (which may be any type of financial institution but is referred to generically herein as a bank) with which it has contracted for credit card network services, and as known in the art, will get an approval or decline message after the acquiring bank contacts the issuing bank of the credit card used by the purchaser. Assuming that the purchase transaction is approved, the user is awarded loyalty points from the merchant based on the amount of the purchase (e.g. 100 points for a $100 purchase). A central server resides on the credit card network and tracks the transaction between the merchant, the acquiring bank, and the issuing bank. A reward account is maintained on the central server on behalf of the merchant and the user, and the number of reward points in the user's account for that merchant is increased accordingly. In an alternative embodiment, the user's reward points are logged in an account maintained by the acquiring bank on behalf of the merchant (with which it has a contractual relationship) and the user. The user may redeem the reward points earned from the transaction with the merchant at a later time, or may redeem the points with another merchant on the credit card network, or may aggregate those reward points with those of other merchants into a central exchange account, and then redeem the aggregated points for goods or services from any approved merchant on the network, depending on the configuration of the system.

Owner:SIGNATURE SYST

Smart wallet

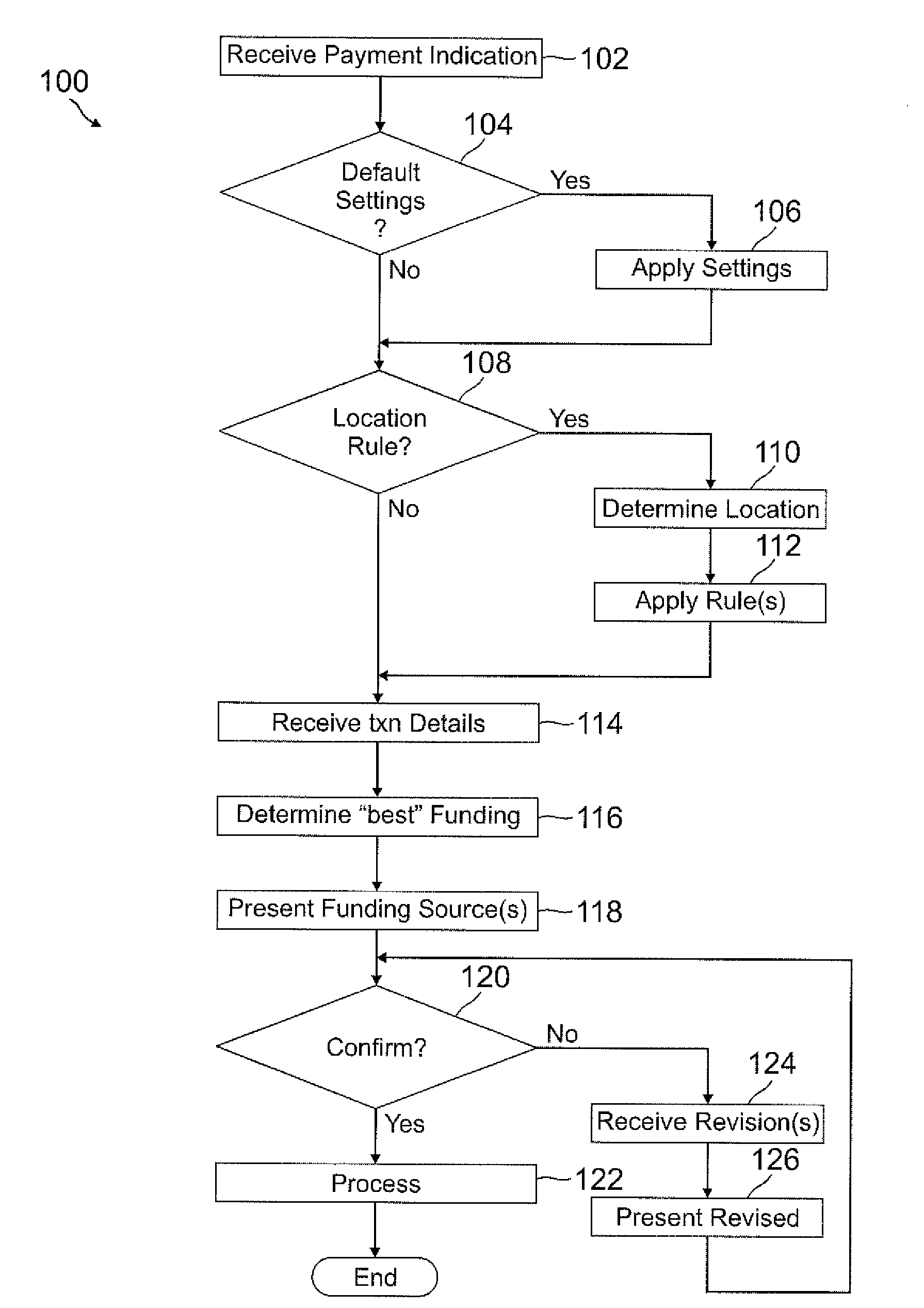

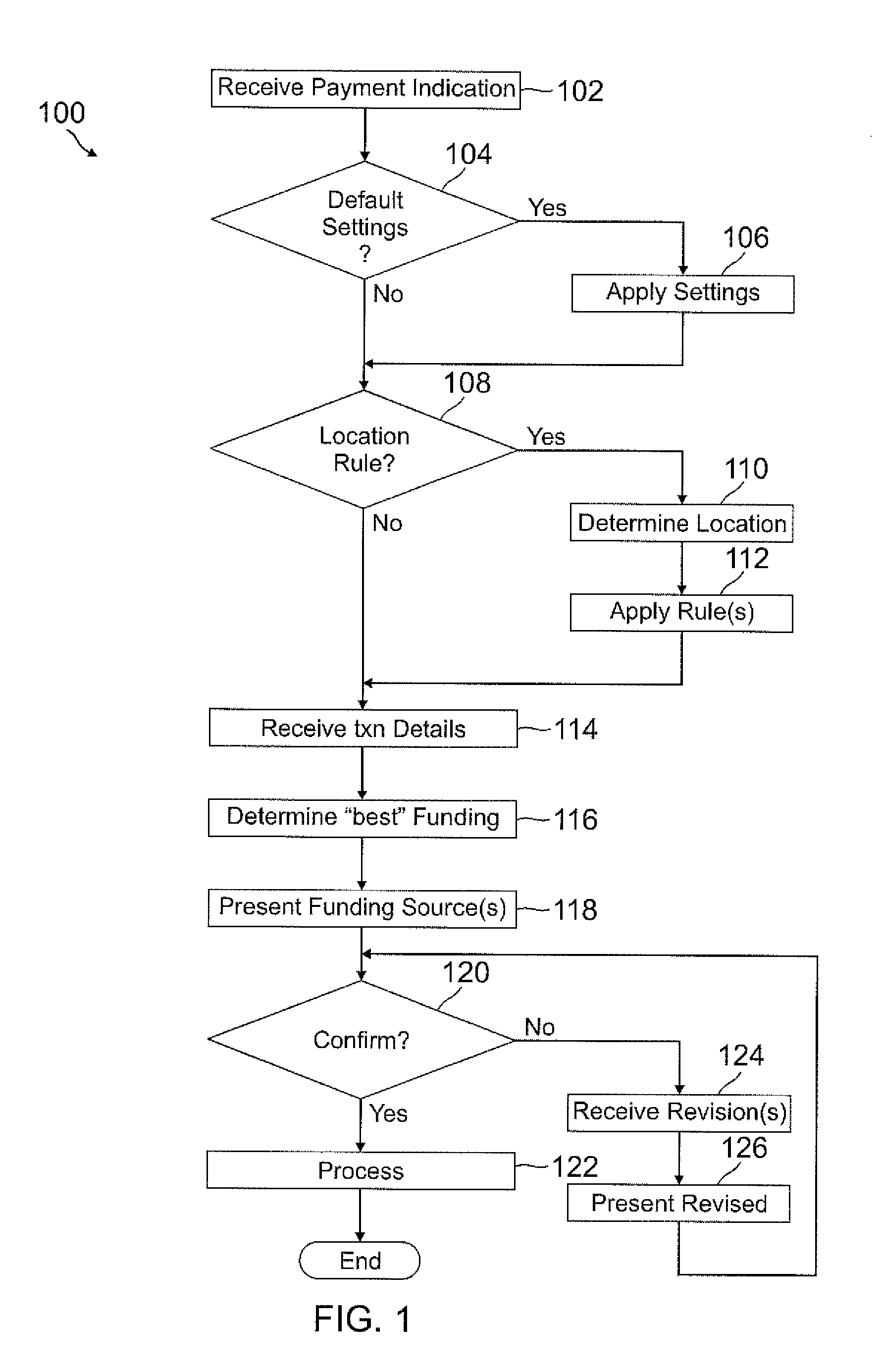

A user's smart phone is used for payments and holding information, similar to what is contained in a physical wallet. Depending on transaction details, user preferences, and location, one or more “best” funding instruments for the transaction are selected for the user, who may then revise if desired. Access to different functions or information within the phone may vary and require different authentication / security levels depending on type of use (e.g., payment or non-payment) and details of use (e.g., high payment amount vs. low payment amount, use of sensitive information vs. non-sensitive information).

Owner:PAYPAL INC

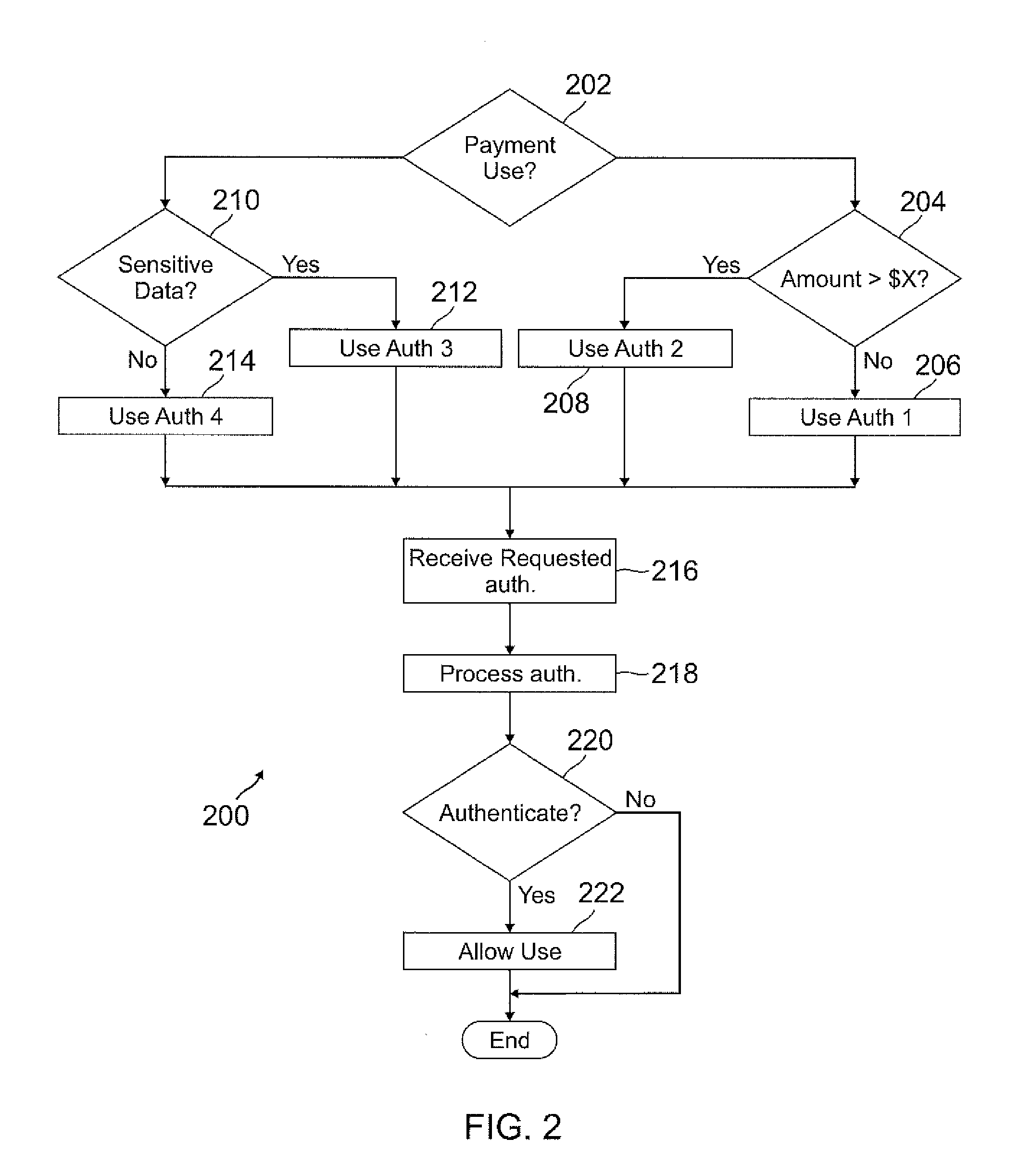

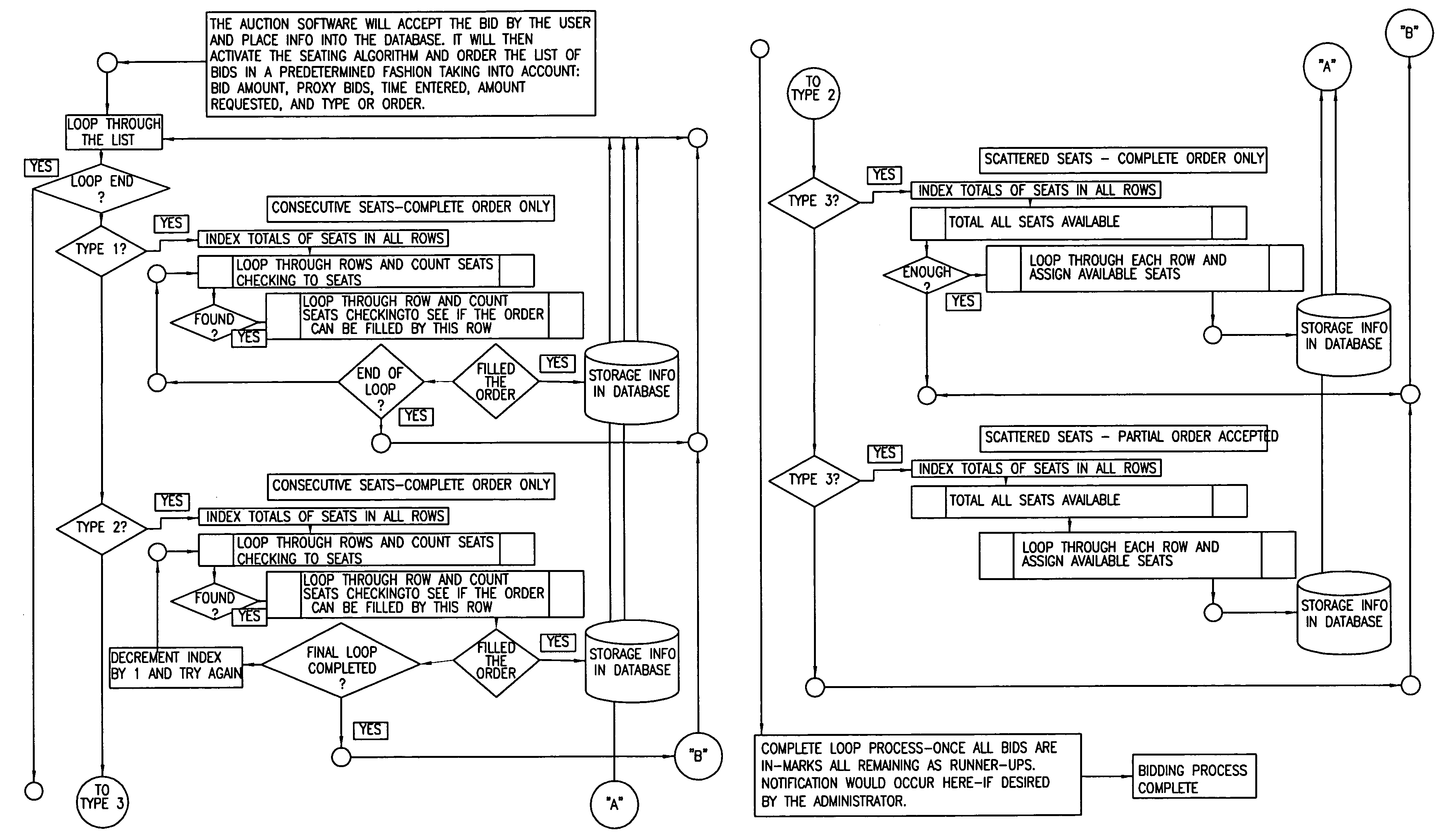

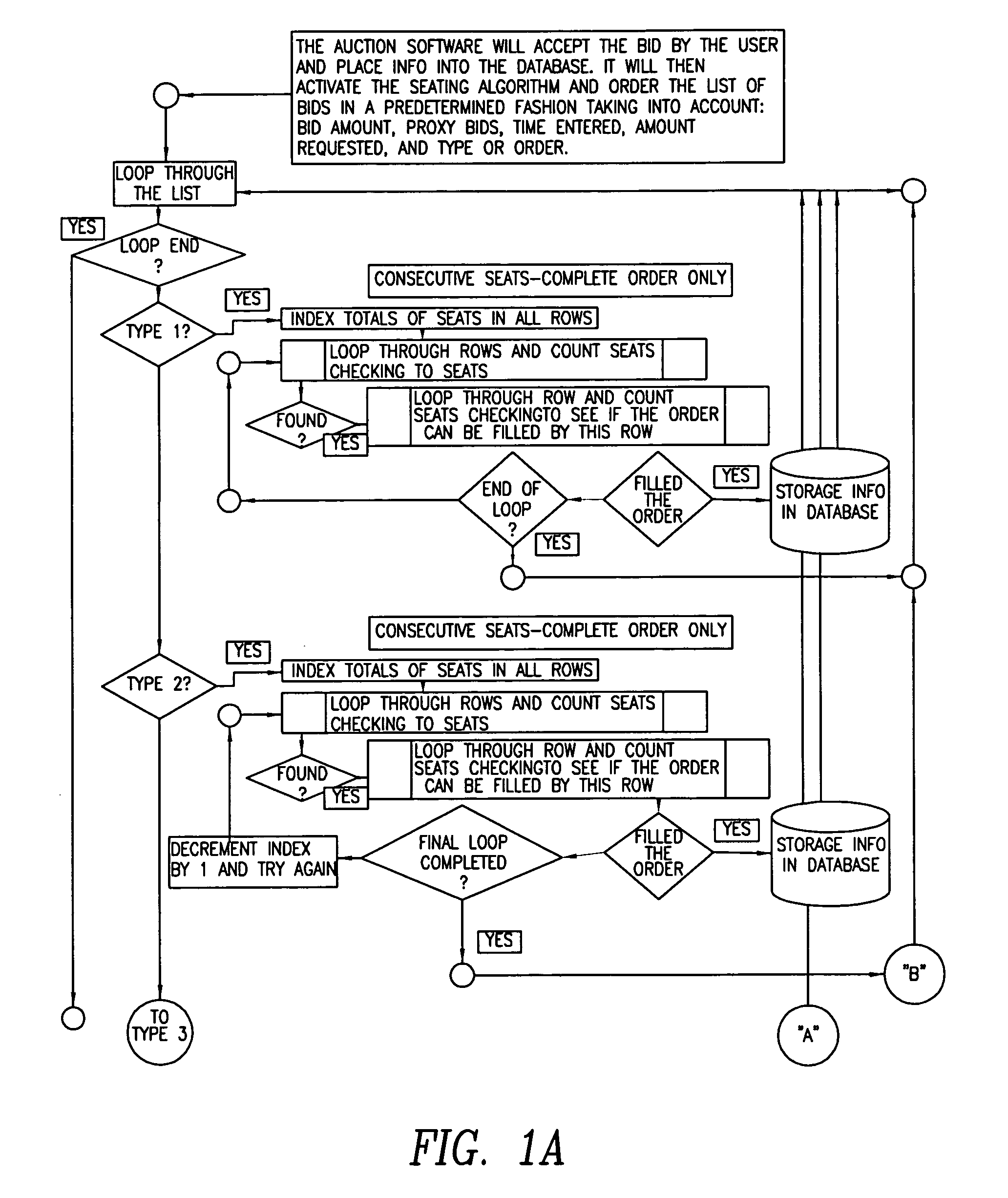

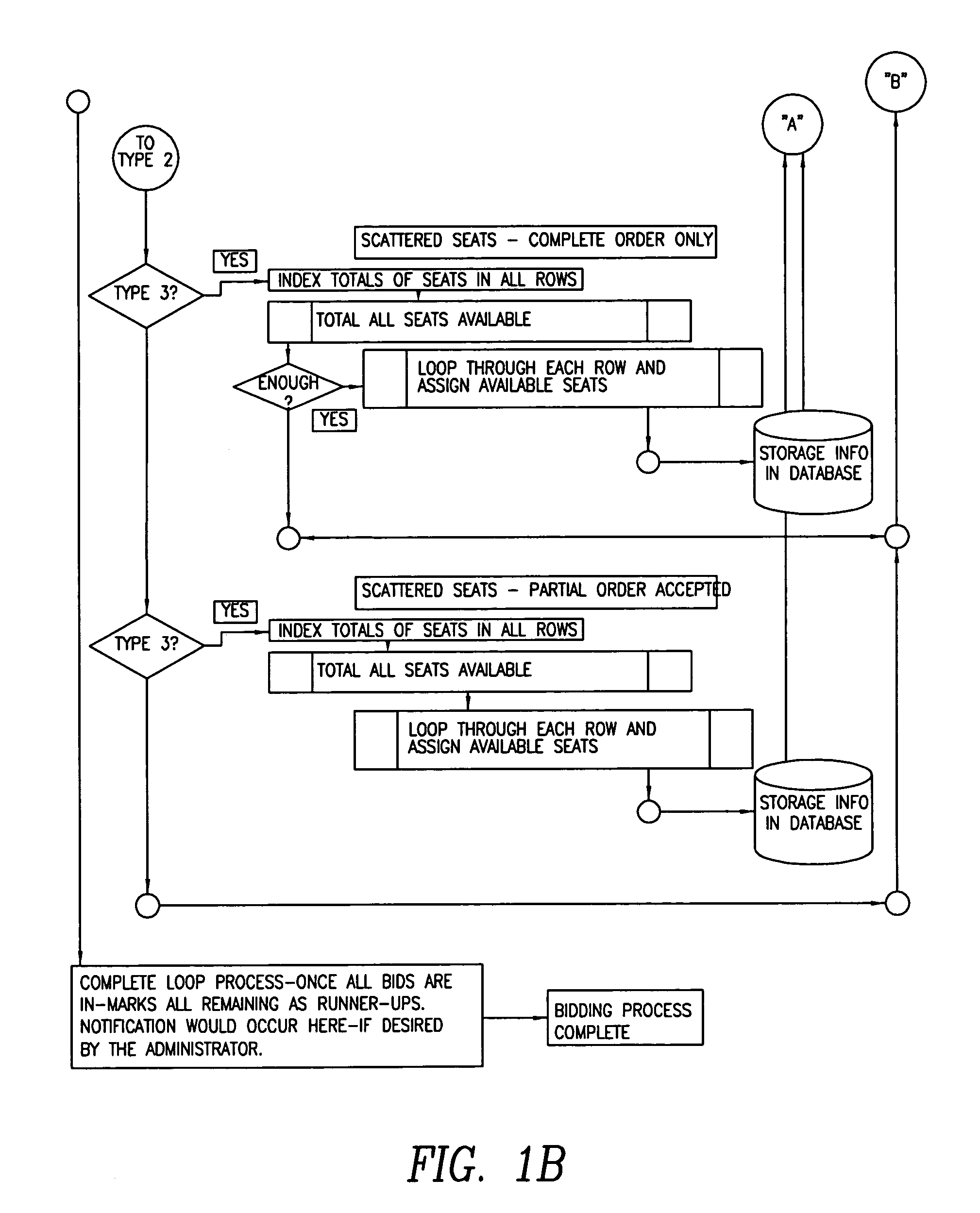

Ticket auction

InactiveUS7003485B1Eliminates chaosIncrease opportunitiesFinanceCommerceAllocation algorithmThe Internet

This computer-based Internet ticket auctioning method preregisters potential bidders and advises them that all bids are conditional offers to purchase tickets, and therefore cannot be lowered or canceled at will. The auction's organizer programs the computer that runs the auction with dates and locations of various events, and with auditoria layout and locations of seats to be auctioned. Each registered customer can view the layout of a particular auditorium and submit a bid for one or more seats. The bidder specifies whether a partially filled order and noncontiguous seat assignments are acceptable. The bidder is also provided with an option to engage a “proxy bid” that will increase the bid amount up to a limit set by the bidder, in order to ensure purchase of tickets. Each customer can also choose to bypass the auction process entirely, by submitting a purchase order at a high, preset price. This preset price is automatically accepted and purchase of tickets is guaranteed. At the conclusion of the auction, the computer runs a seat allocation algorithm that assigns the seats to the bidders so as to maximize the total amount realized from the auction. The seat assignment algorithm is also run periodically during the auction in order to determine which bidders have already being outbid, and to allow them to raise their bids.

Owner:F POSZAT HU

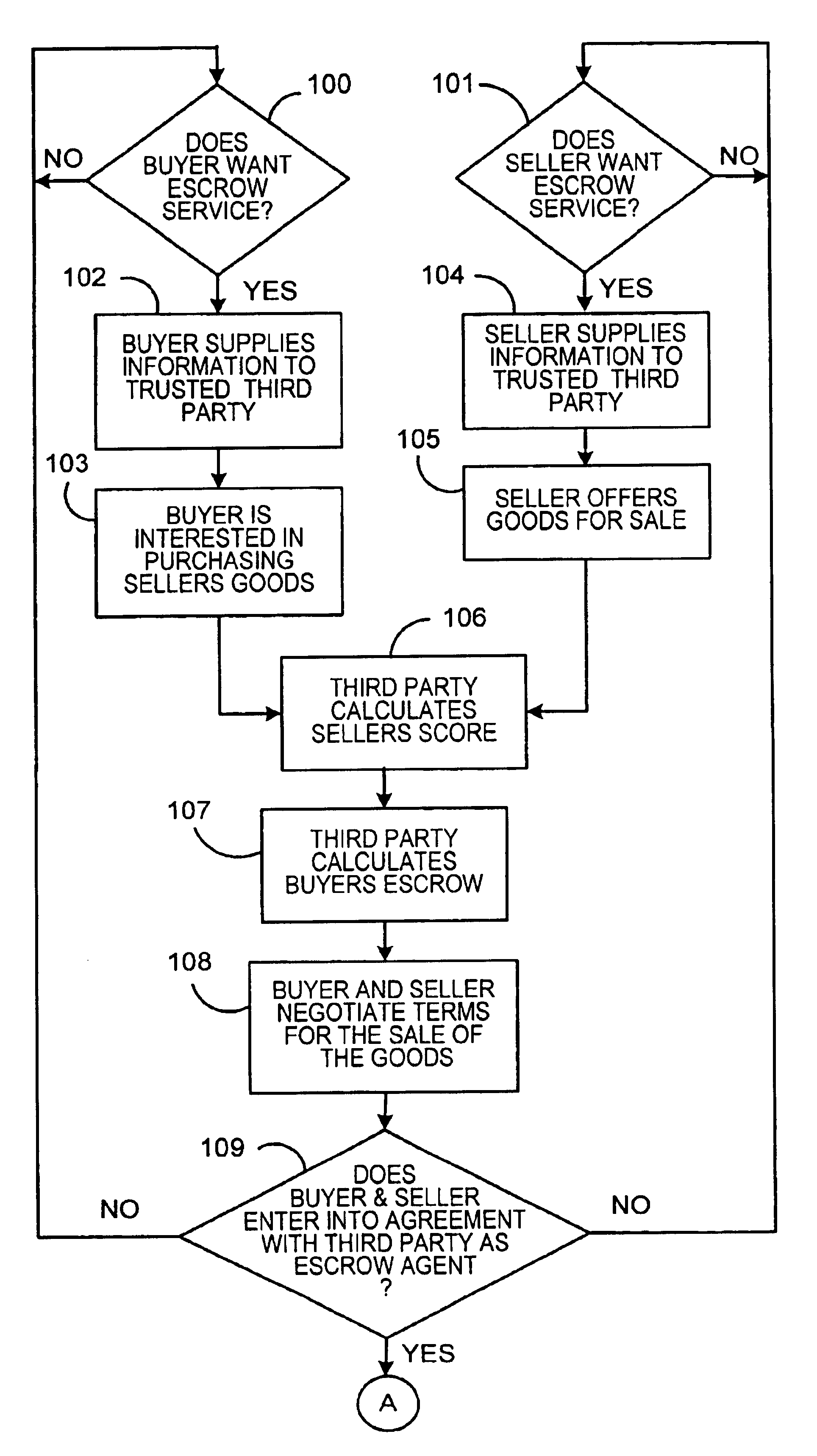

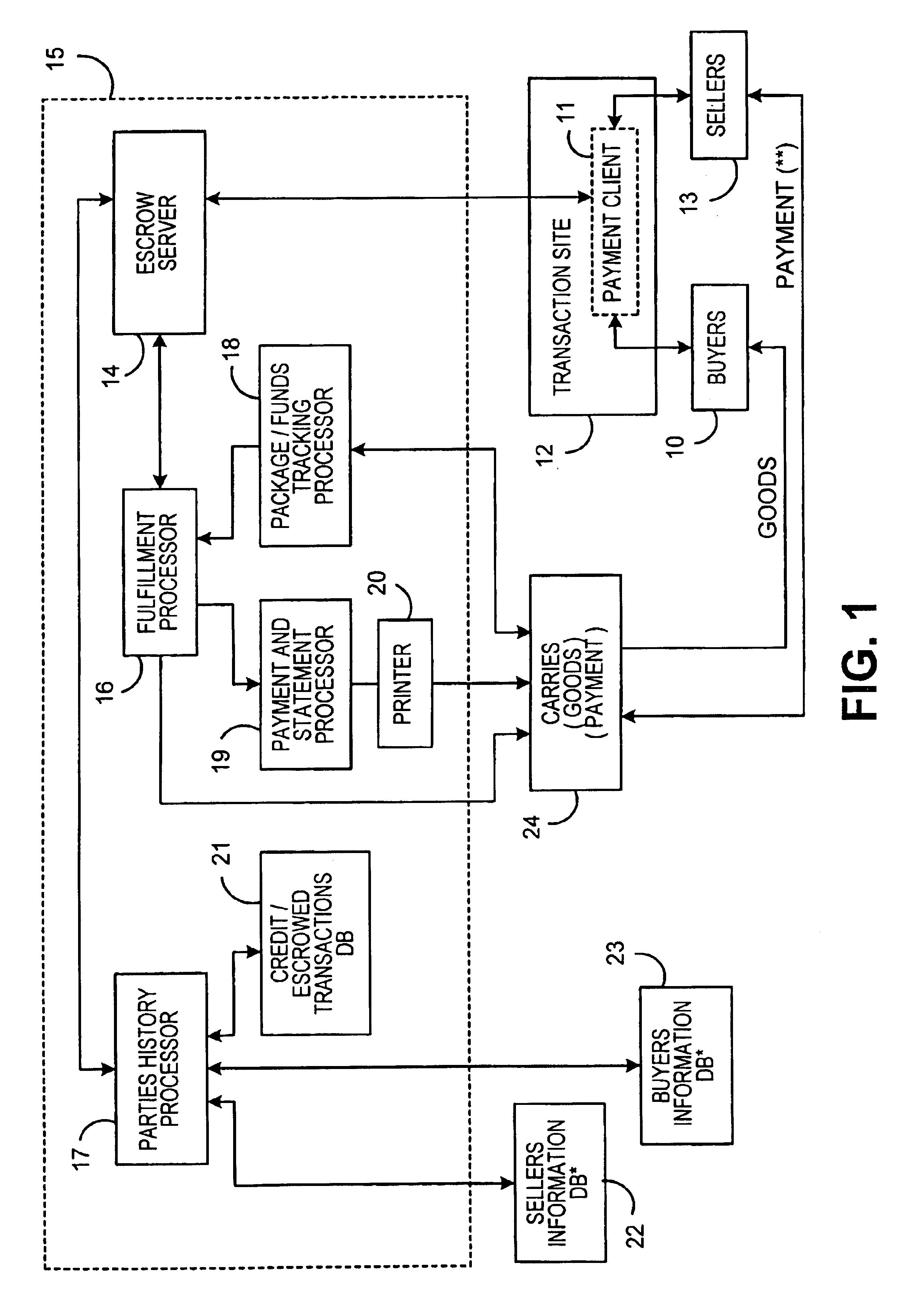

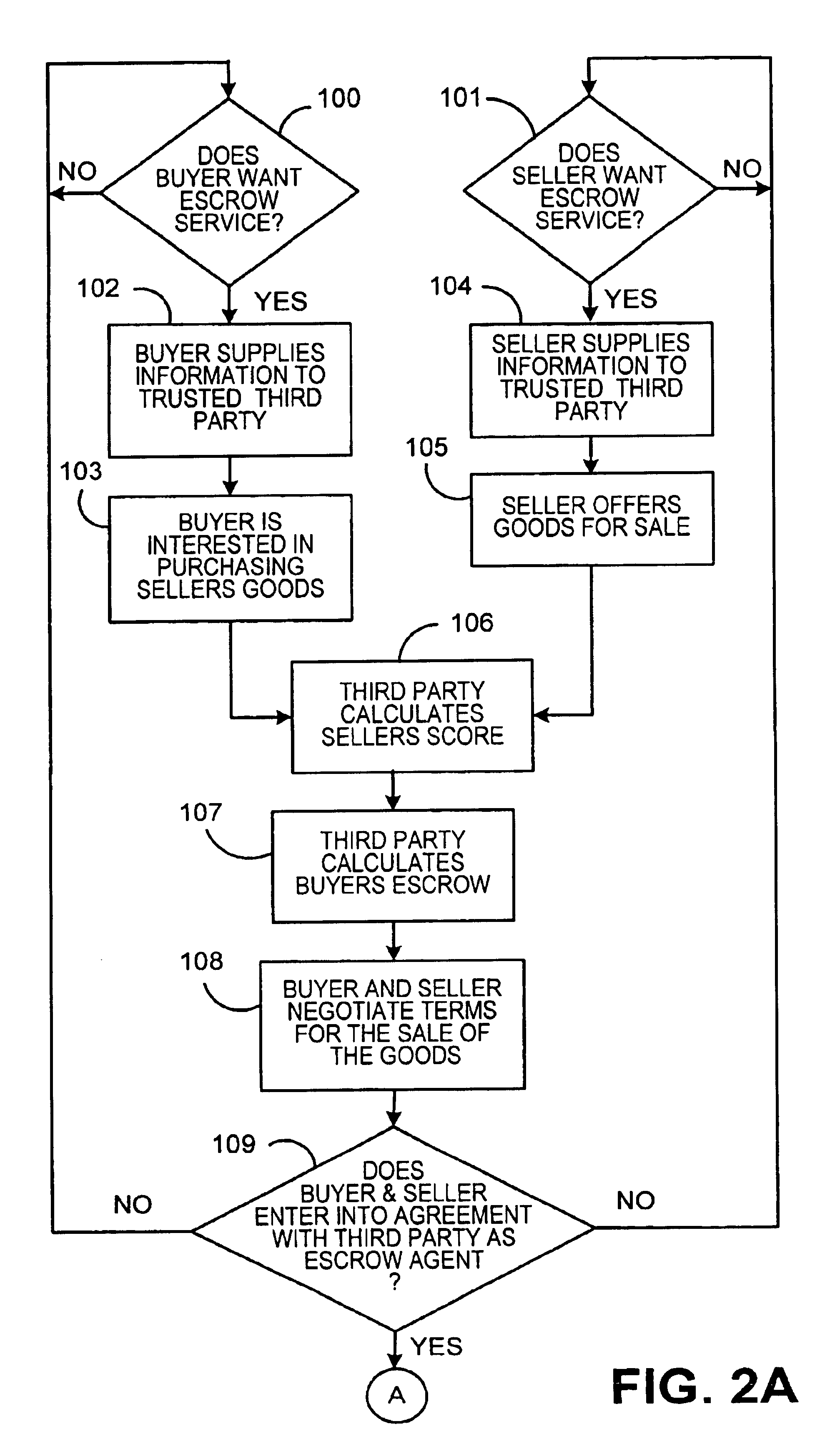

System for conducting business over the internet

An Internet-based system that allows a buyer and a seller to obtain information about each other while remaining somewhat anonymous. The system provides historic information to buyer and seller by having a trusted third party give the buyer and seller the other party's trading history information without revealing the actual identity of the parties. A buyer registers with the trusted third party by submitting an online application. The trusted third party establishes a credit score for the buyer. A seller registers with the trusted third party by submitting an online application. The trusted third party establishes a score for the seller based upon the seller's trading history, reputation and financial standing. When the buyer chooses to purchase a product from a seller over the Internet, certain parameters i.e., dollar value of transaction, type of purchase, level of current outstanding credit available, credit score, etc. are substituted into an algorithm to determine the maximum purchase amount that may be financed at what terms and how much money the buyer will have to place in escrow. The buyers escrow may be furnished to the trusted third party by credit cards, ACH, wire transfer, etc. If the trusted third party is not satisfied with the seller's score, the trusted third party may require the seller to post a bond for some or all of the seller's transactions.

Owner:PITNEY BOWES INC

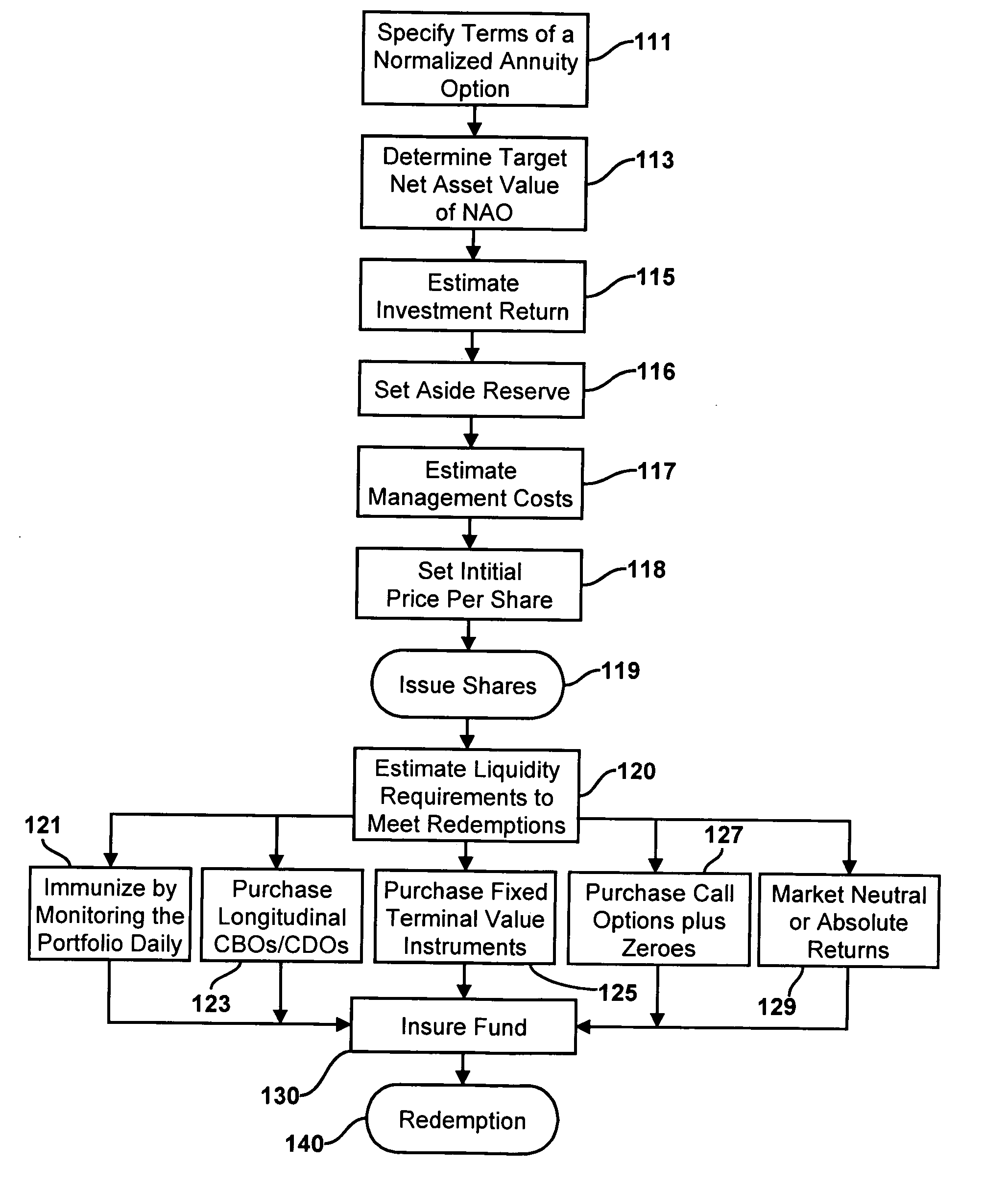

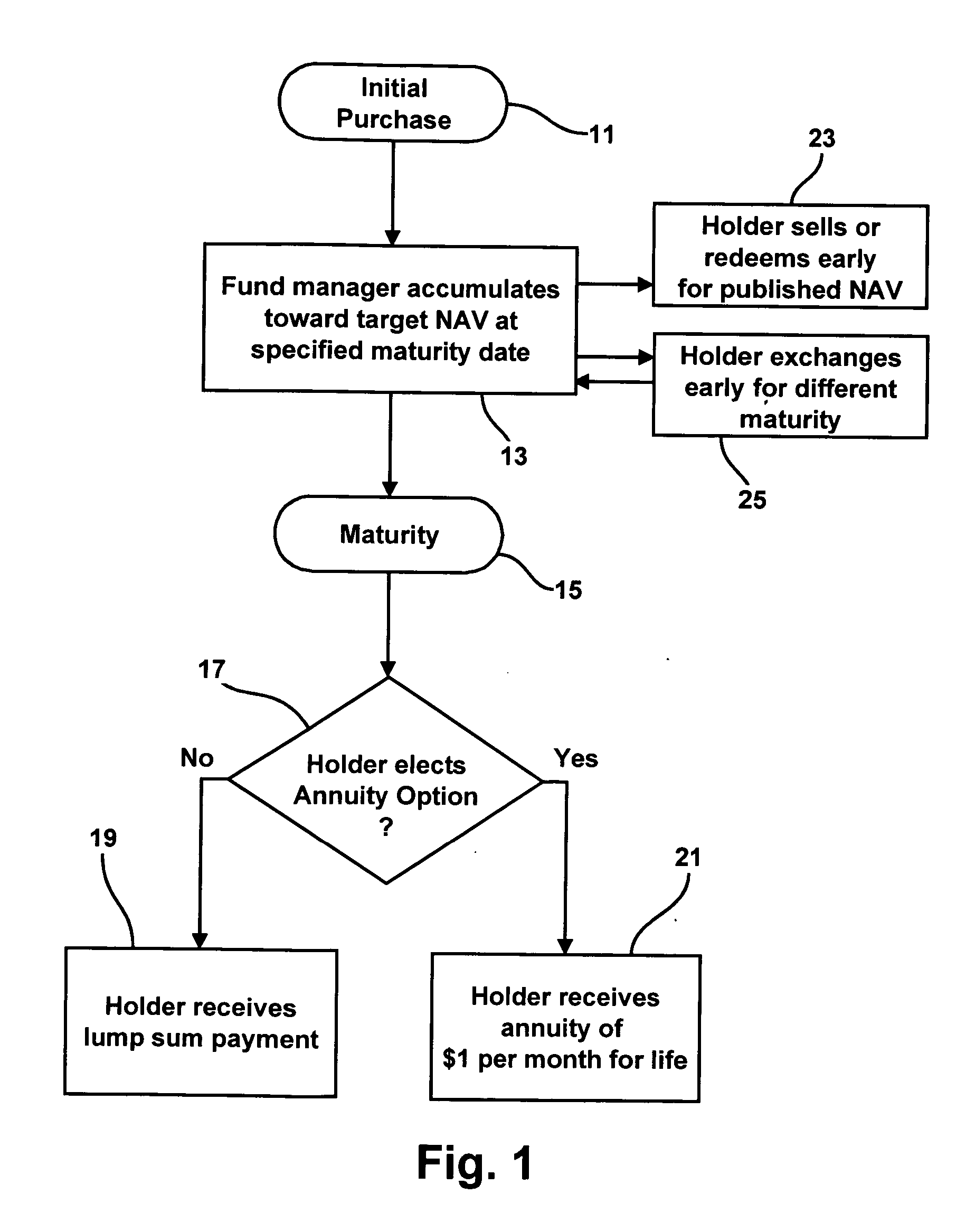

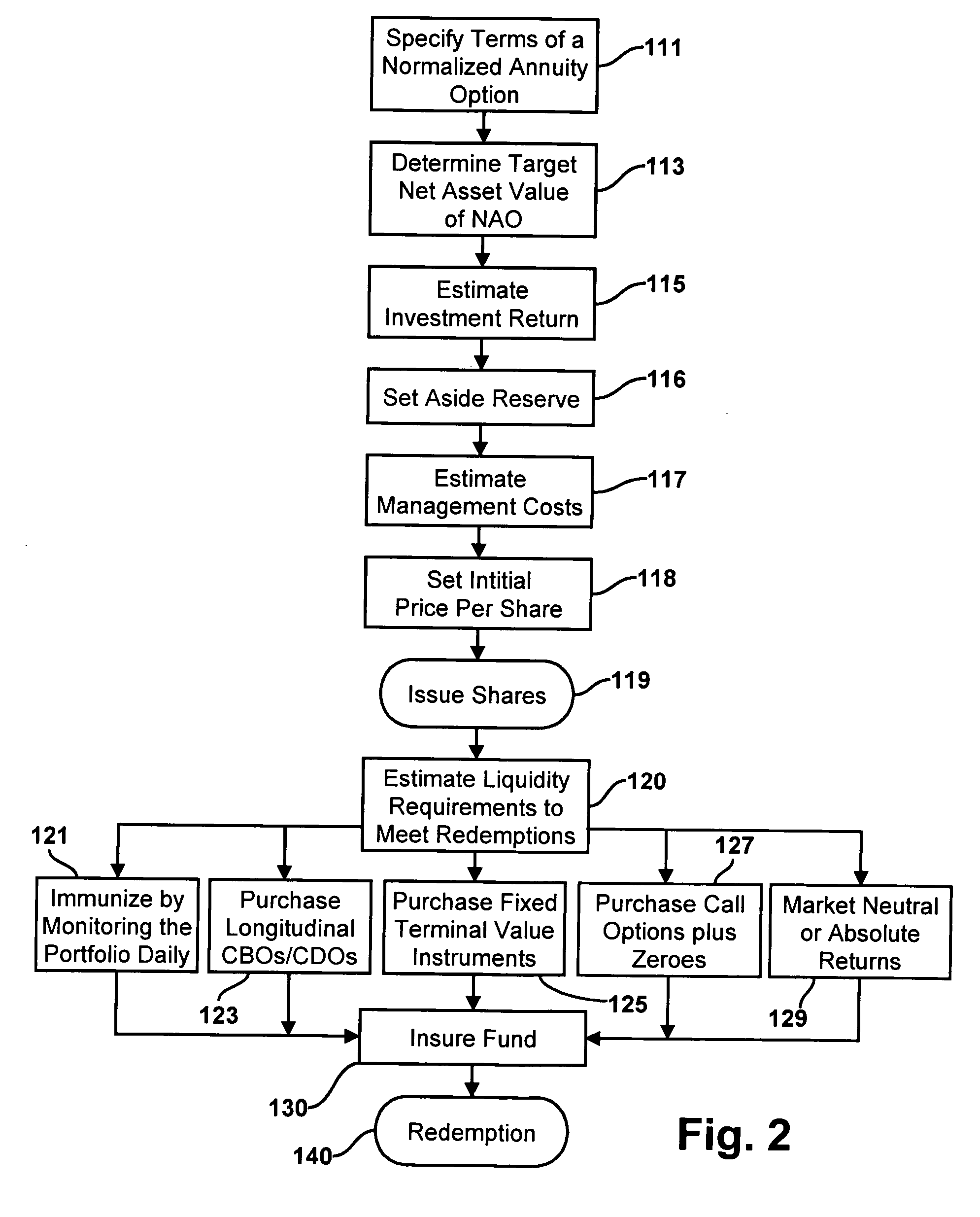

Methods for issuing, distributing, managing and redeeming investment instruments providing normalized annuity options

A method of issuing and managing investment instruments called “Pension Shares” which preferably take the form of securities that represents a claim against and is secured by an investment fund. A Pension Share entitles its holder to receive, at a specified maturity date, either a lump sum payment amount or, at the option of said holder, to receive a sequence of annuity payments. The Pension Share issuer creates and manages the investment fund such that its net asset value at the maturity date will be adequate to make the lump sum payment or provide the holder with the annuity. A preferred form of Pension Share provides an annuity option of one dollar per for the life of the holder, or his or her survivor, both of whom are at a predetermined age at the maturity date. A Pension Share may be redeemed on demand in advance of the maturity date so that it may be exchanged for a Pension Share having a different maturity date if the holder's plans change.

Owner:RETIREMENT ENG

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com